Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

1055 results about "Financial trading" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Financial trading is about buying and selling assets in the hope of making a profit. You can trade cash instruments such as forex and shares or derivatives such as CFDs and options. Financial trading is carried out via an exchange or over the counter. Companies, individuals, institutions and even governments trade.

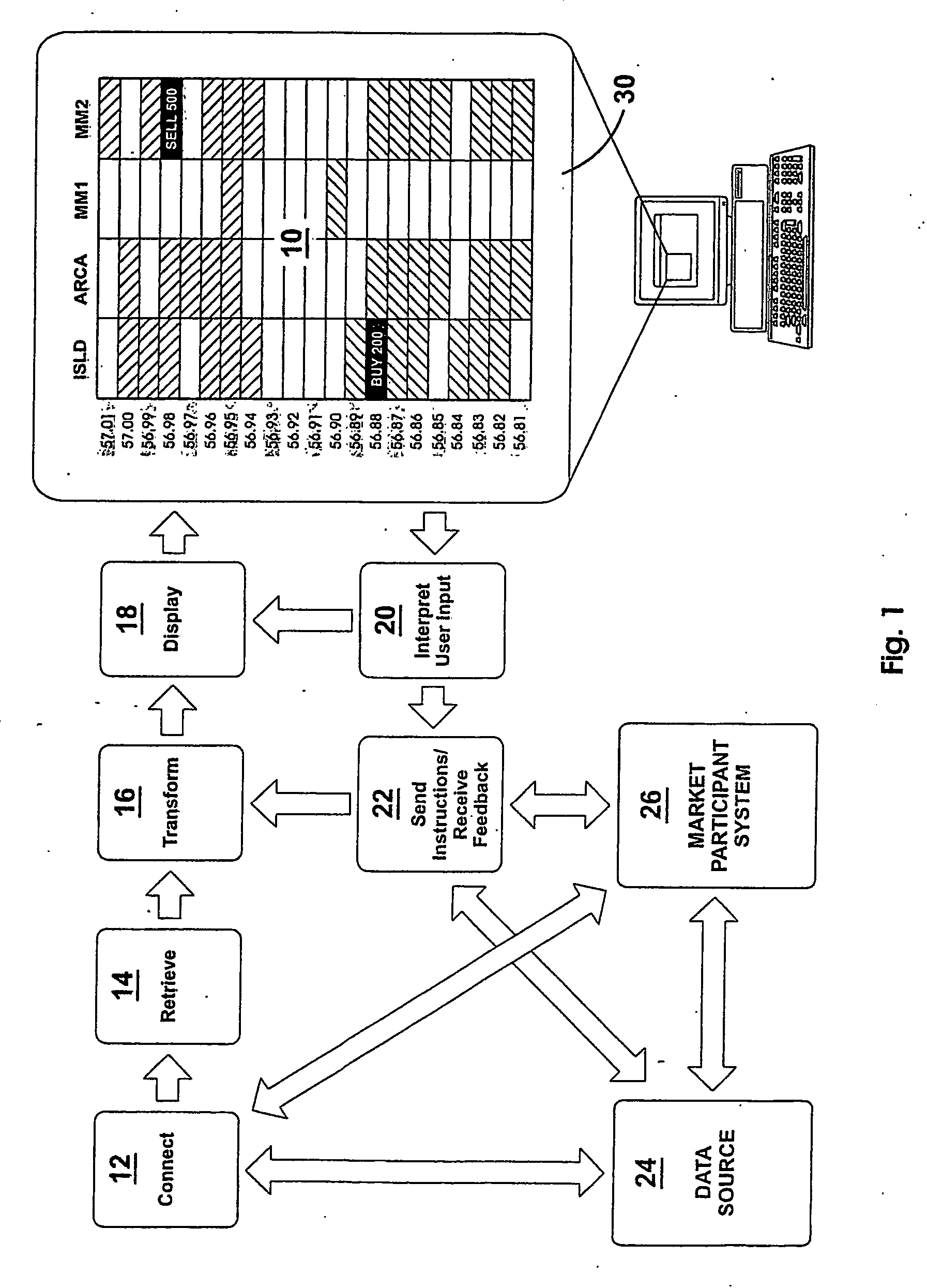

Method of buying or selling items and a user interface to facilitate the same

InactiveUS20060069635A1Easy to useFast and efficient and intuitive and user friendlySpecial service provision for substationFinanceMarket placeFinancial transaction

A method of buying or selling items having at least one market and its associated processes are disclosed. The method includes the steps of, under control of a client system, displaying information identifying at least one item and a bid and / or ask price for the item in the market; and specifying transaction conditions based on a user directed position of a moveable icon, where the transaction conditions are related to the buying or selling of the identified item in the active market. Then, in response to an action of the user sending a user transaction request at the transaction conditions displayed at the time of said action, facilitating financial transactions for the user in accordance with the transaction conditions to complete the transaction. In this manner, the item may be bought or sold by the user at the transaction conditions specified. A user interface to facilitate this method is also disclosed. A quantity recommendation system to facilitate the quantity decision of a financial transaction is further disclosed.

Owner:RAM PRANIL

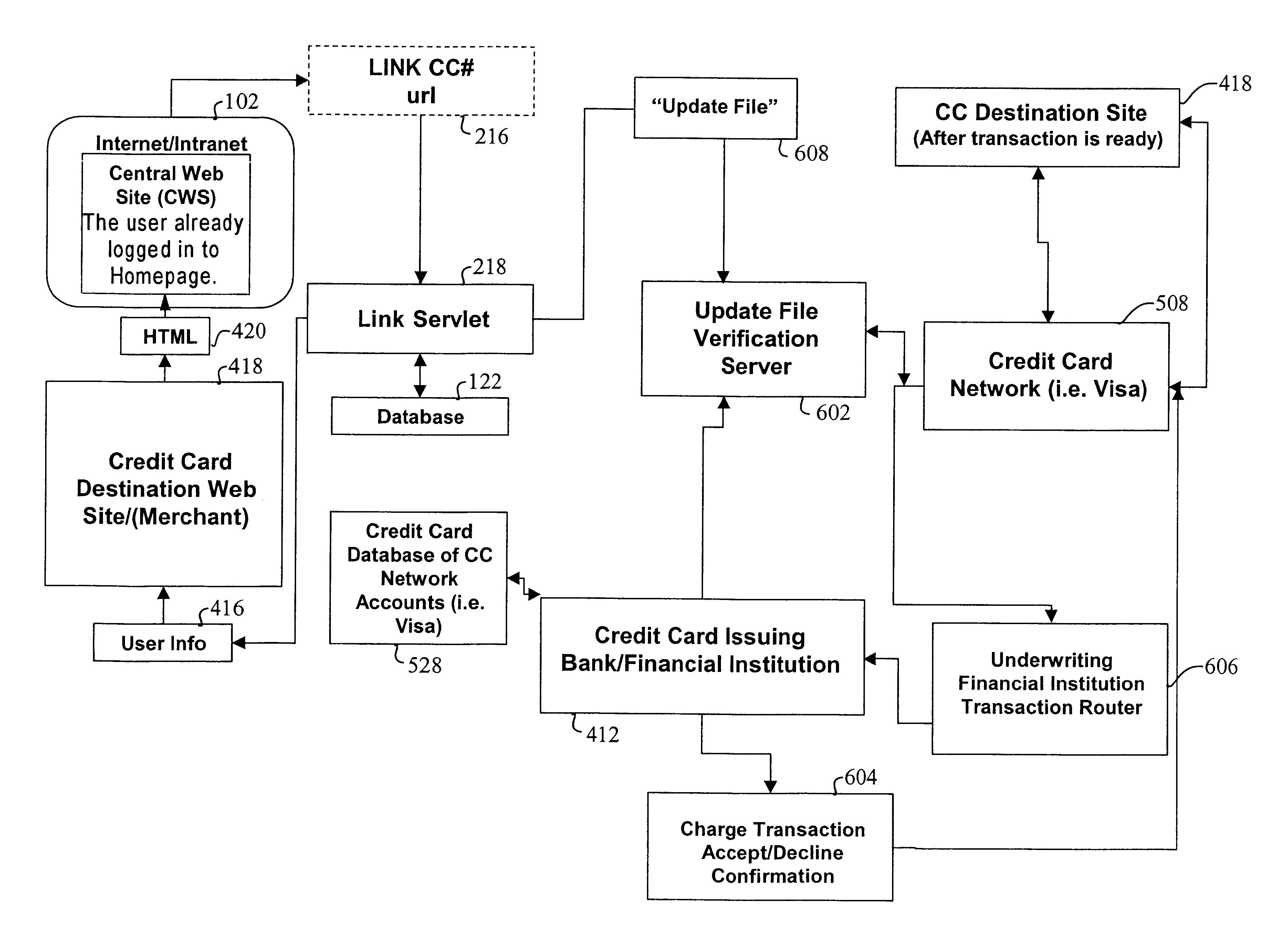

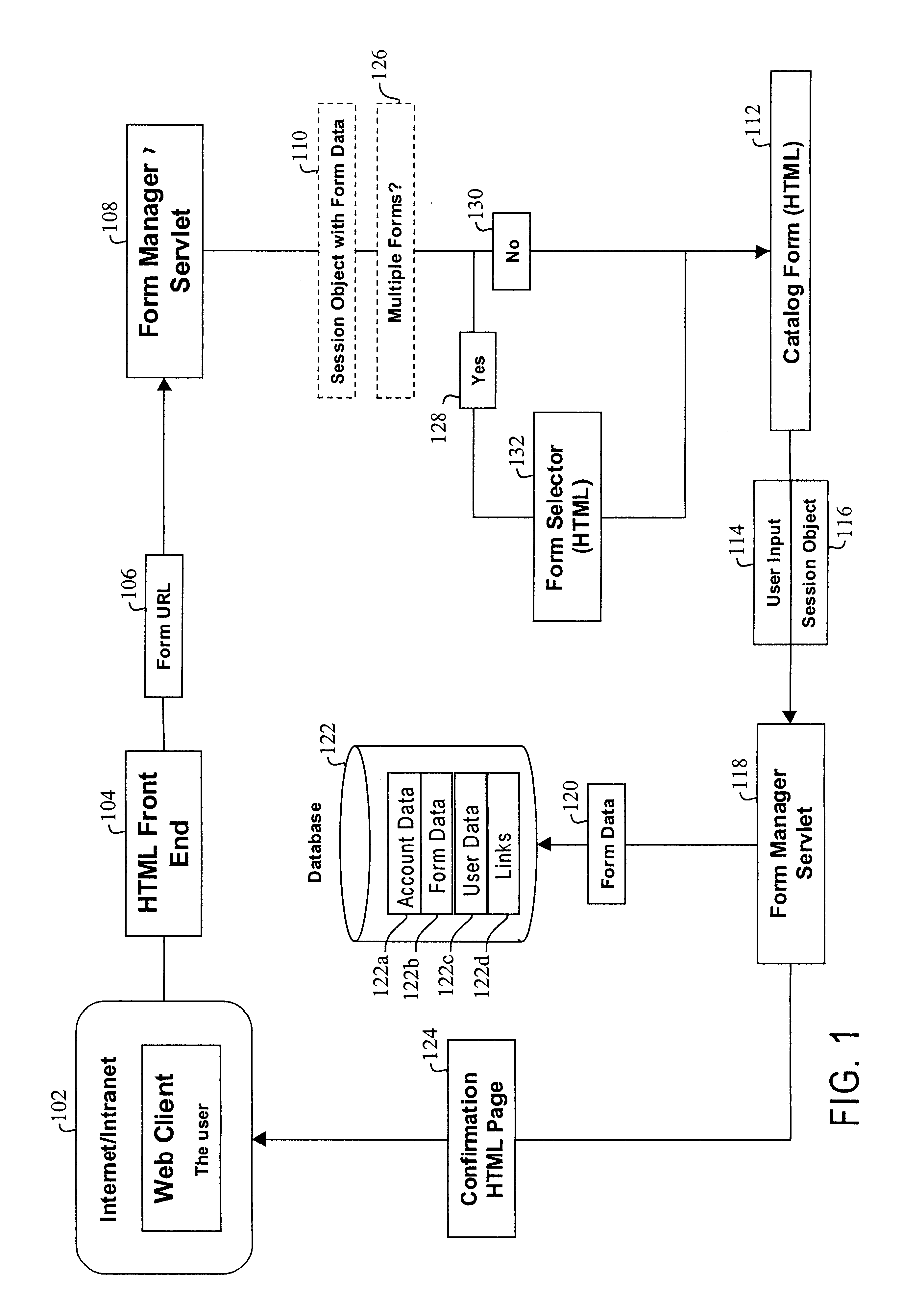

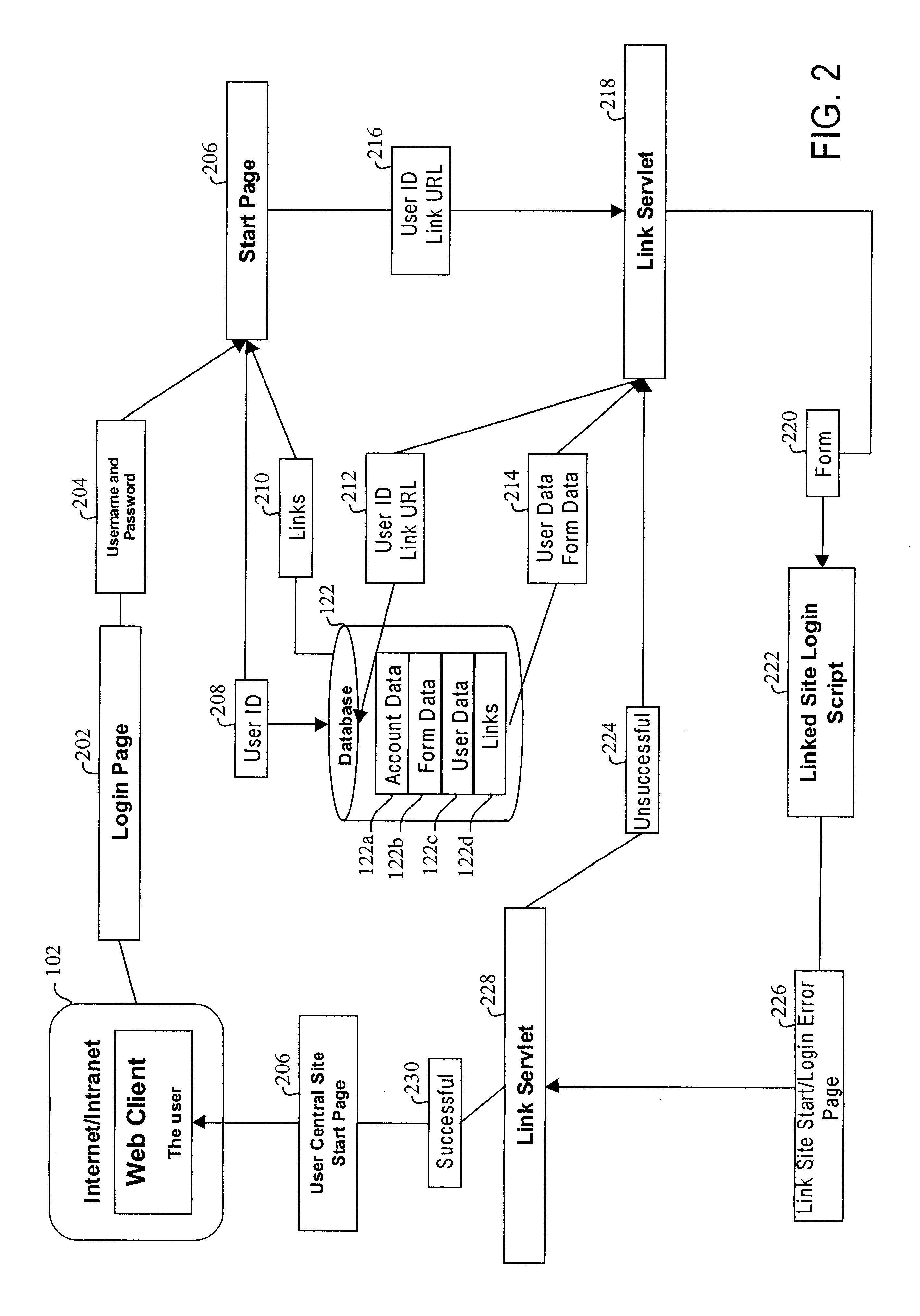

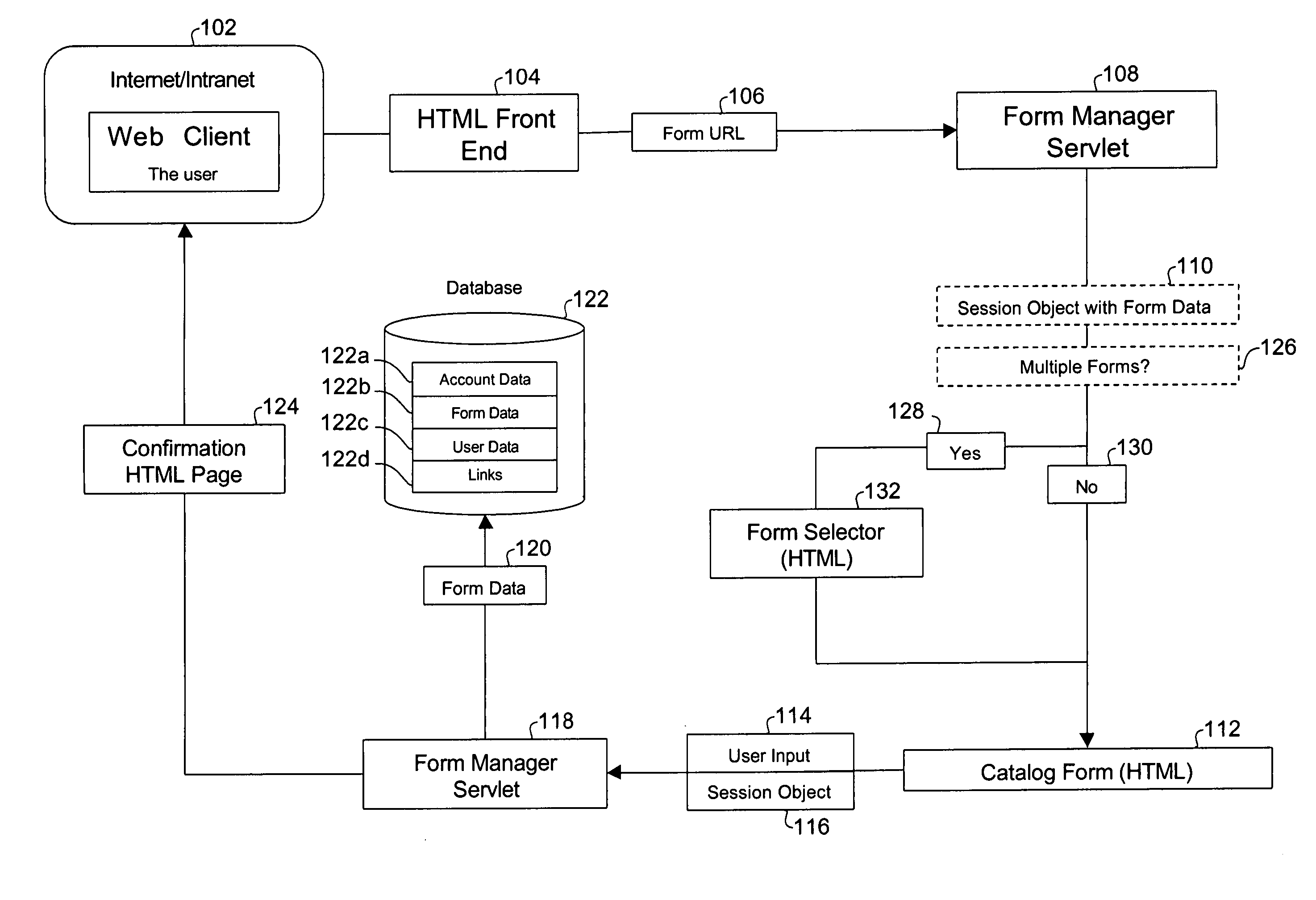

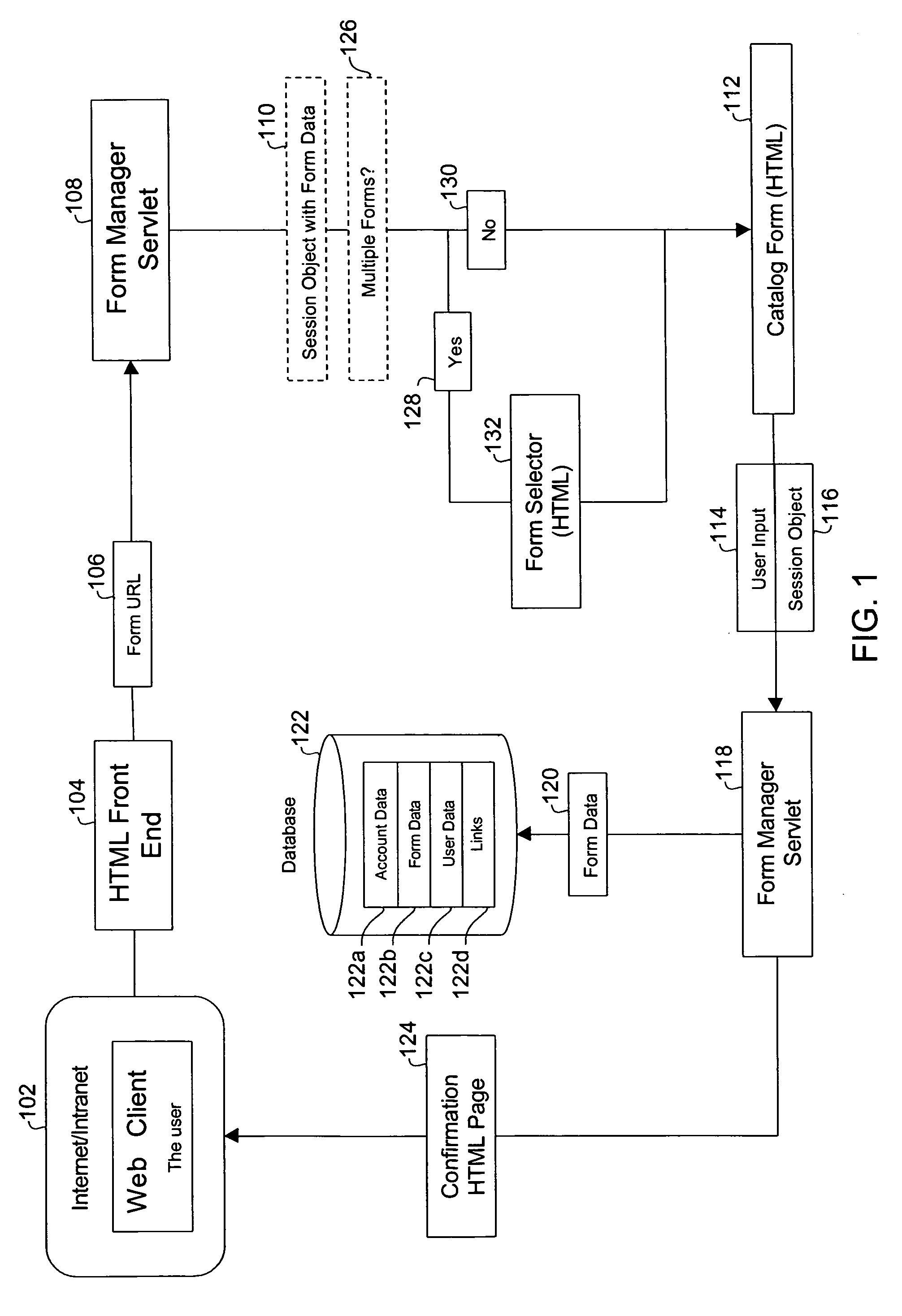

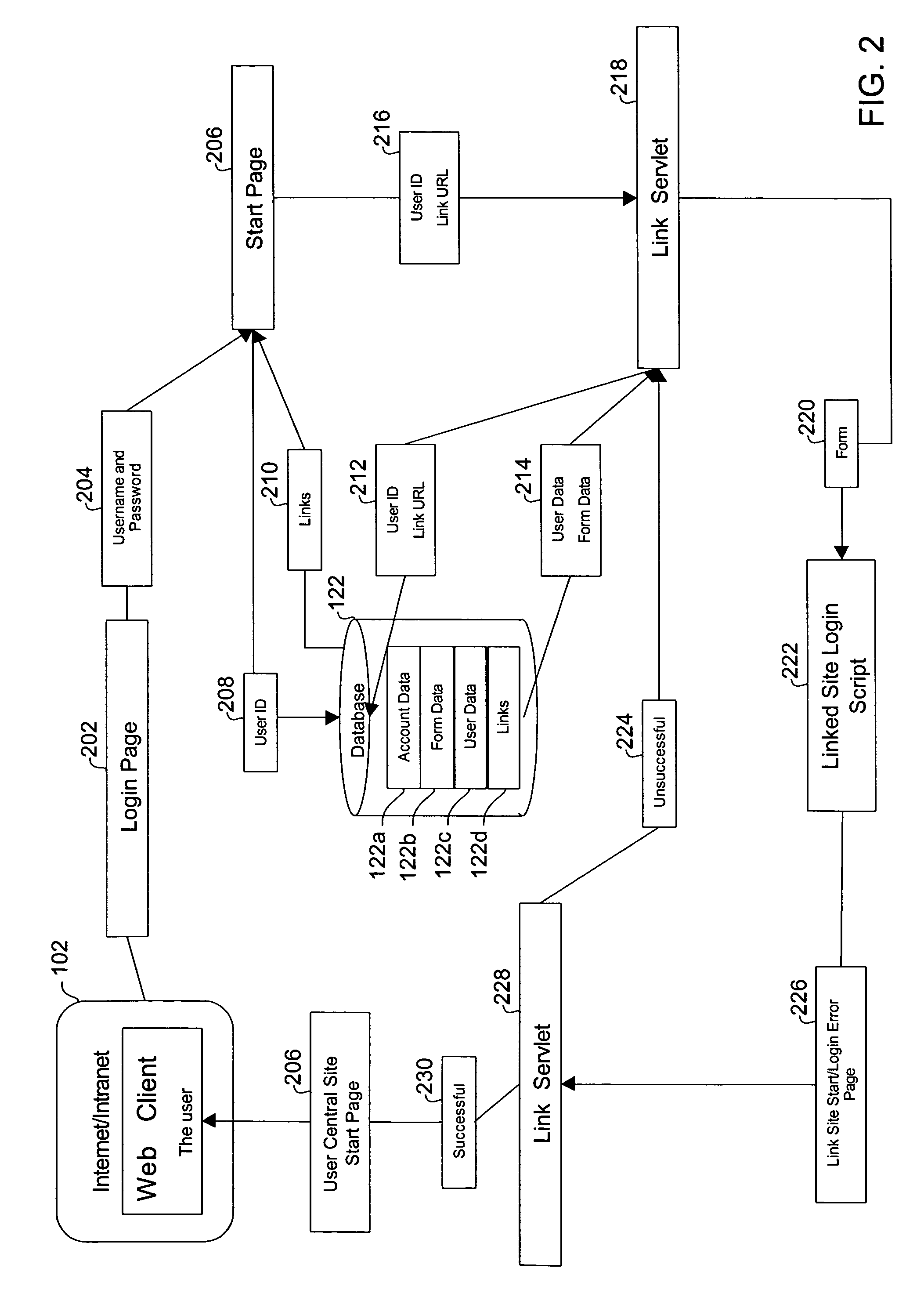

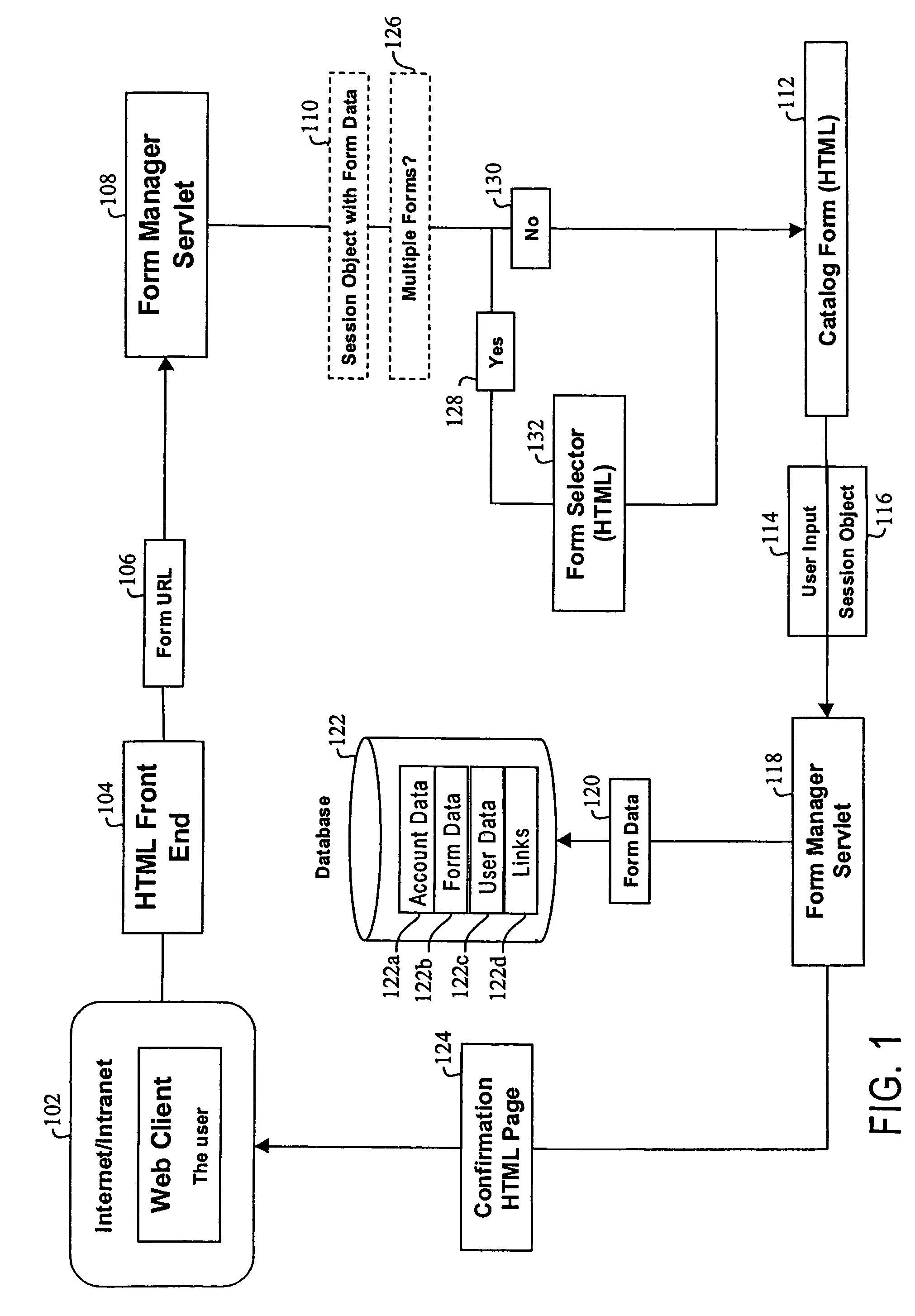

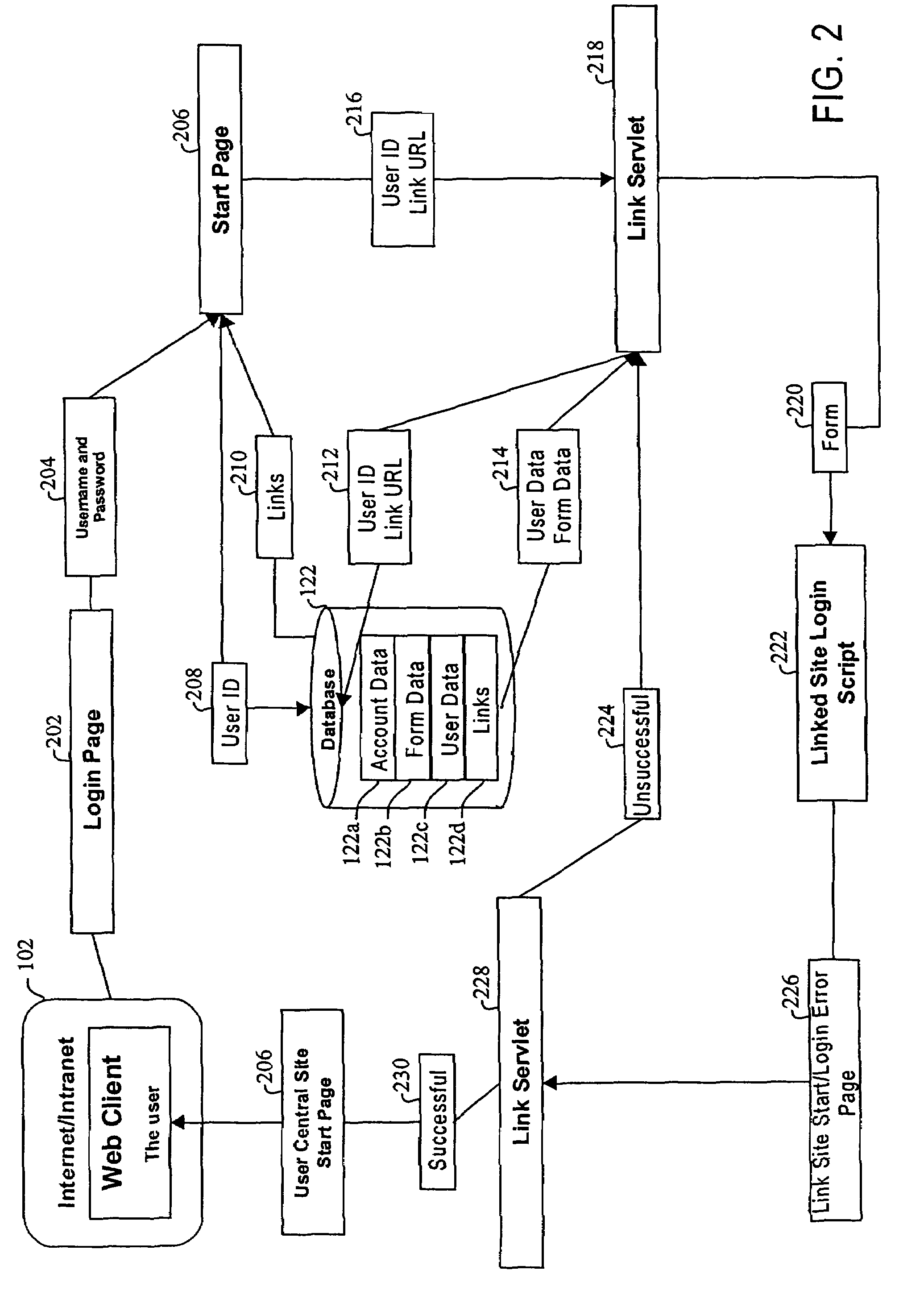

Method, system and computer readable medium for web site account and e-commerce management from a central location

InactiveUS6879965B2Minimizing activation timeMinimizing financial exposureComplete banking machinesAcutation objectsWeb siteData field

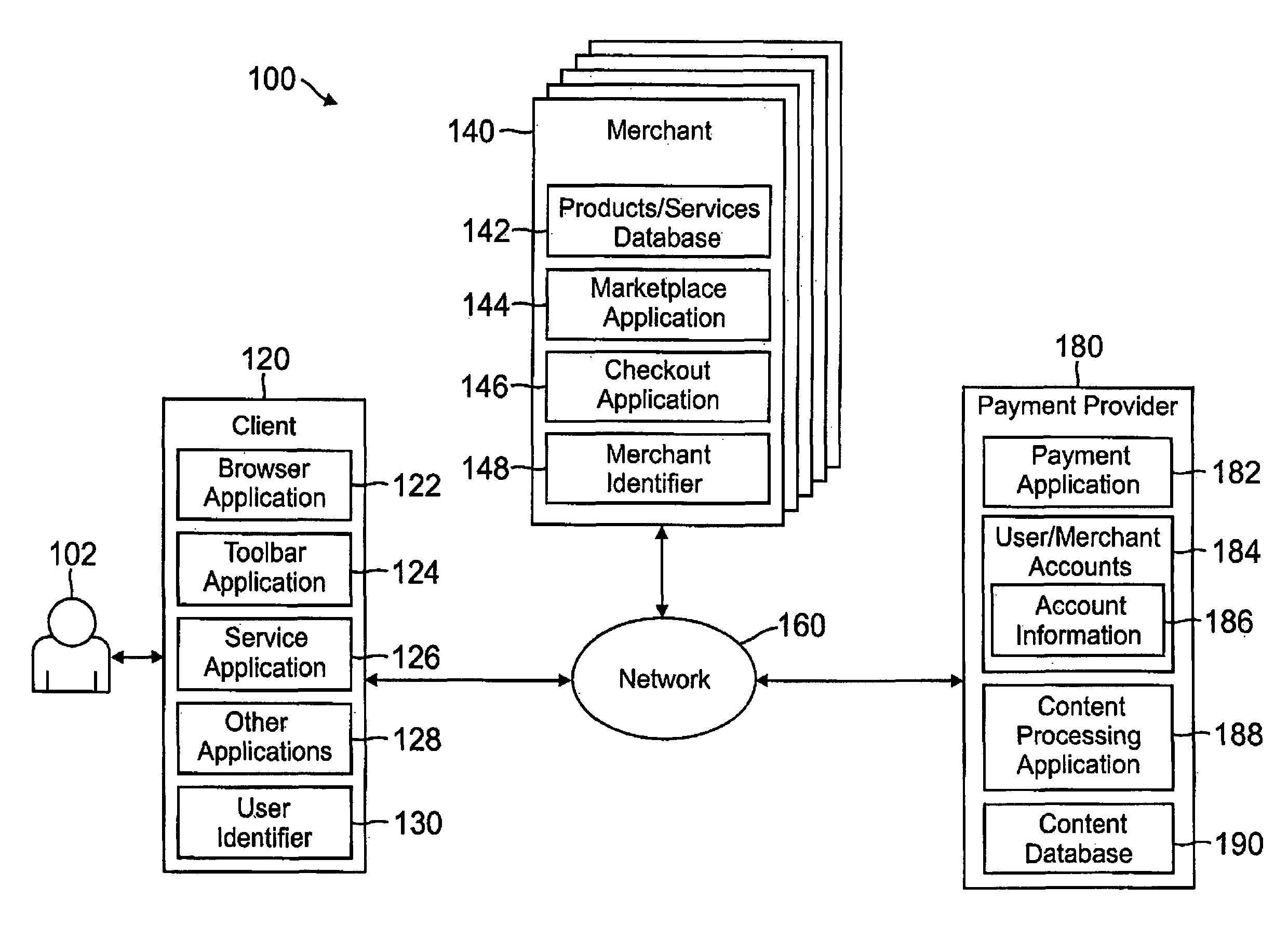

A method, system and computer readable medium for, from a central Web site, performing at least one of registering a user at a destination Web site, logging in a user at a destination Web site and managing an online financial transaction at a destination Web site, including parsing a form Web page of the destination Web site to extract form data fields therefrom; mapping form data fields of a central Web site form to corresponding extracted form data fields of the form Web page of the destination Web site; and using the mapped form data fields to perform at least one of registering a user at the destination Web site, logging in a user at the destination Web site and managing an online financial transaction of a user at the destination Web site. In another aspect, there is provided a method, system and computer readable medium for managing an online or offline financial transaction of a user, from a central Web site, including generating financial transaction account information for a user based on existing credit or debit card information; gathering from the user one or more limits that are applied to a financial transaction performed based on the financial transaction account information; receiving from a source information indicating that an online or offline financial transaction using the financial transaction account information is in progress; applying the one or more limits gathered from the user to approve or disapprove the online or offline or online financial transaction that is in progress; and transmitting an approval or disapproval signal to the source based on a result of the applying step.

Owner:SLINGSHOT TECH LLC

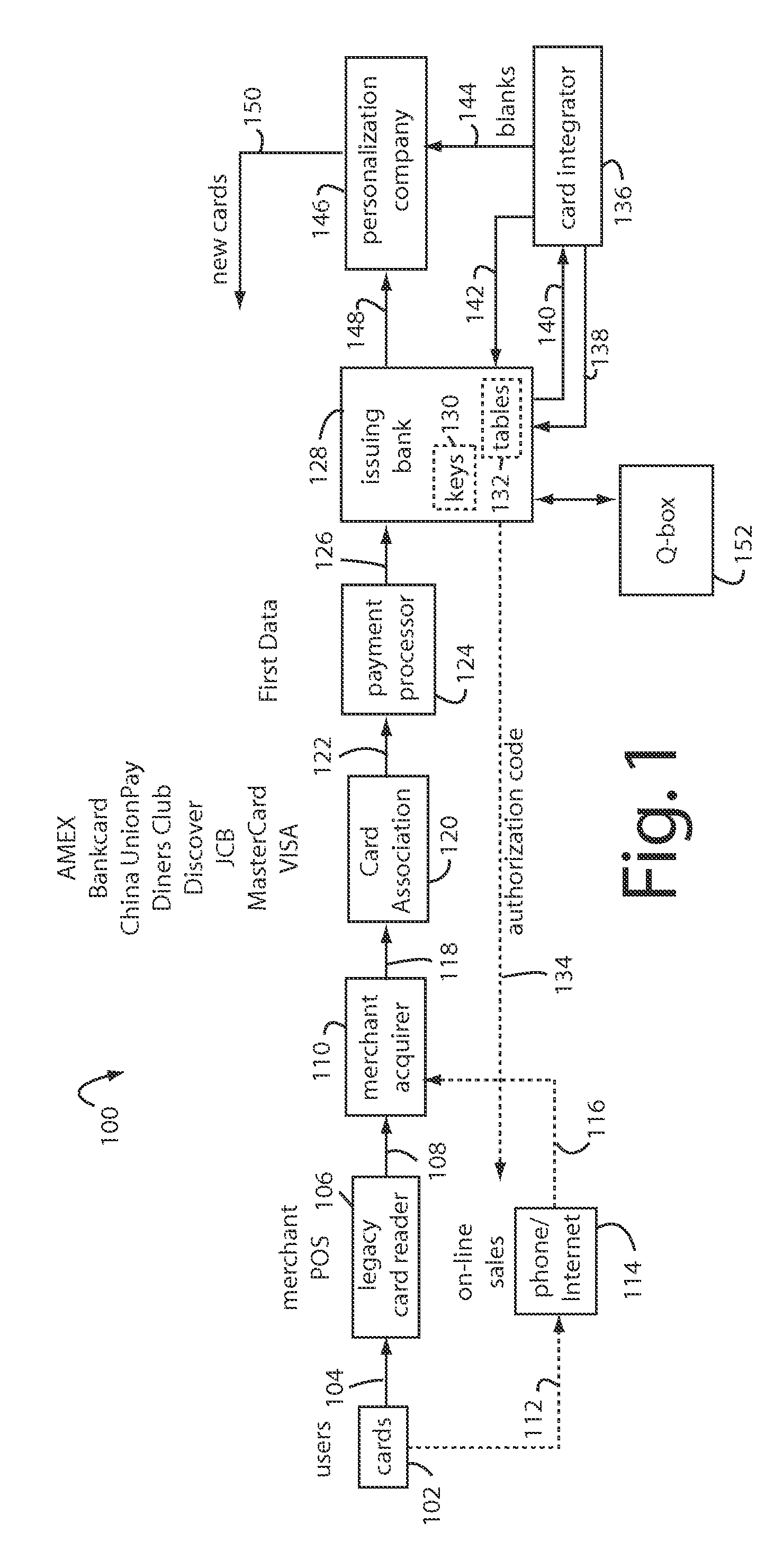

Financial transactions with dynamic personal account numbers

ActiveUS7580898B2Sufficient dataComputer security arrangementsPayment architecturePersonalizationIssuing bank

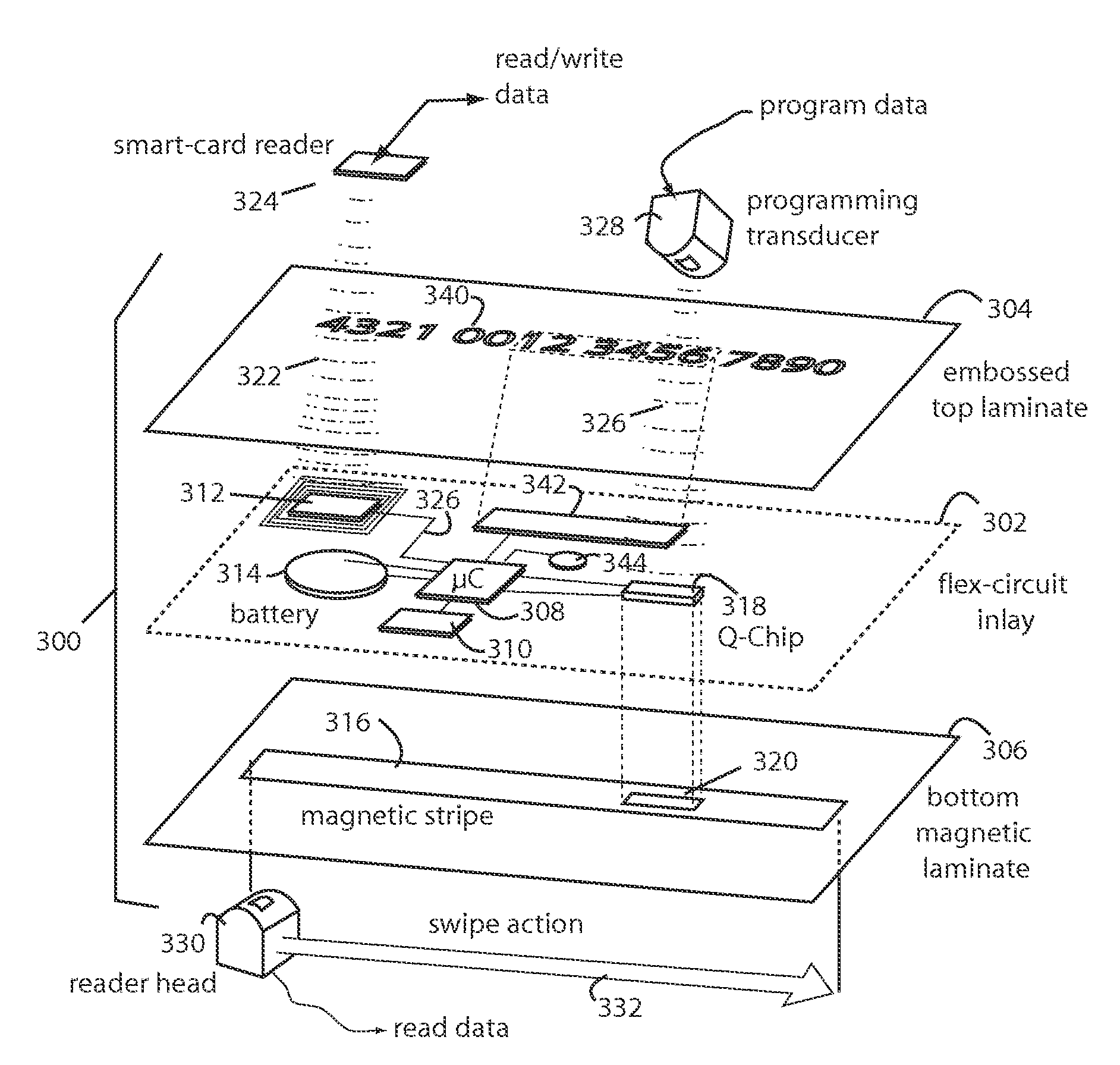

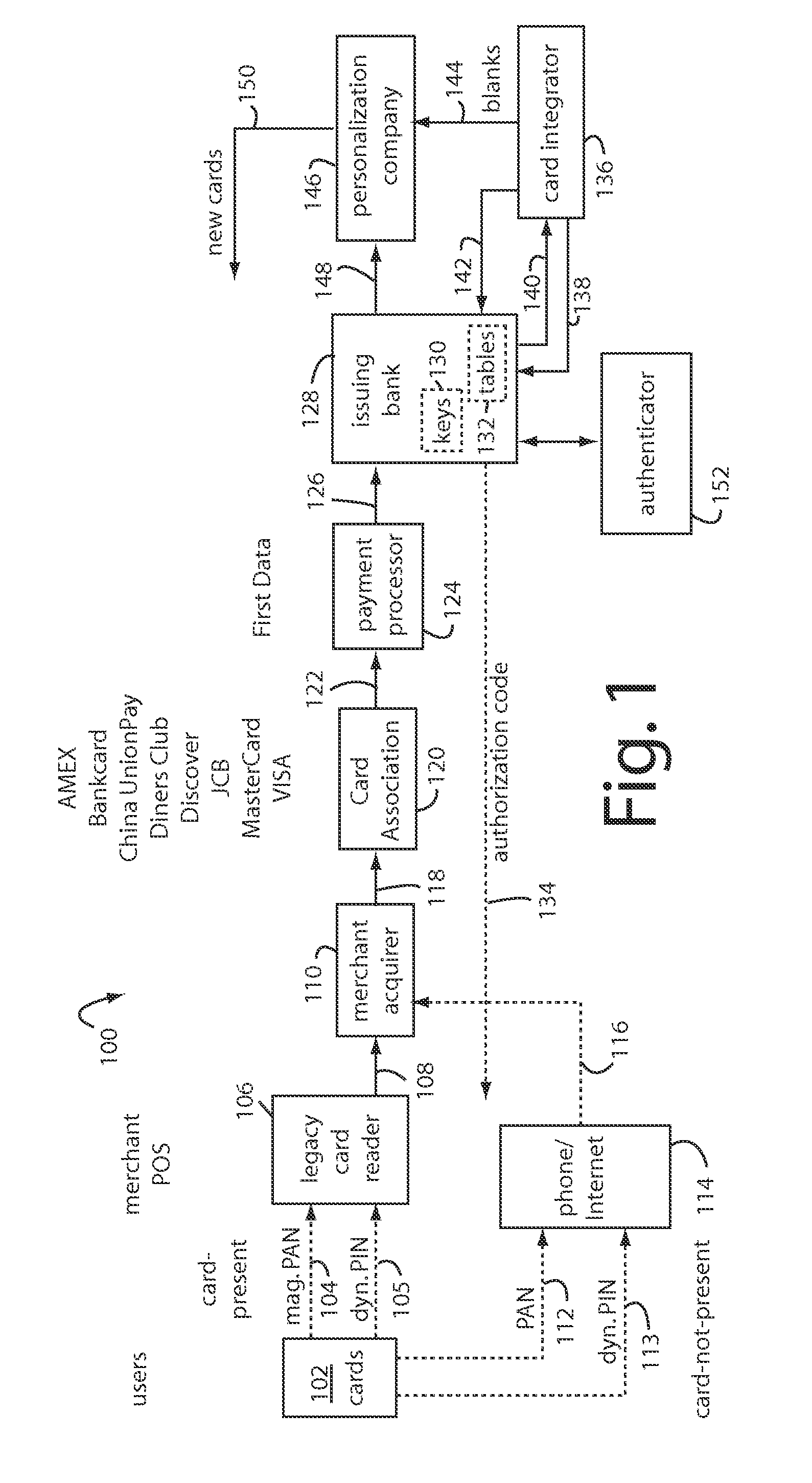

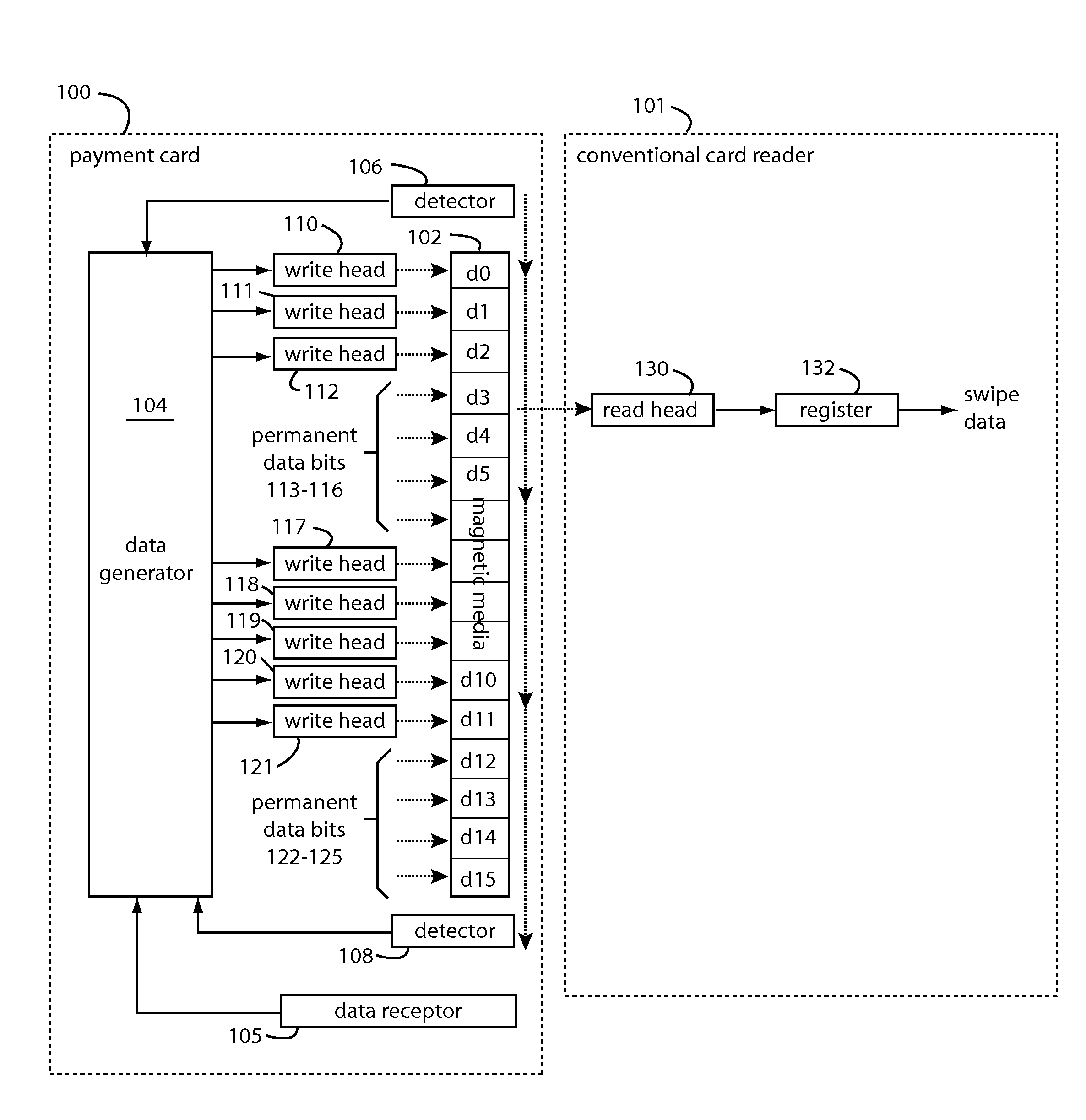

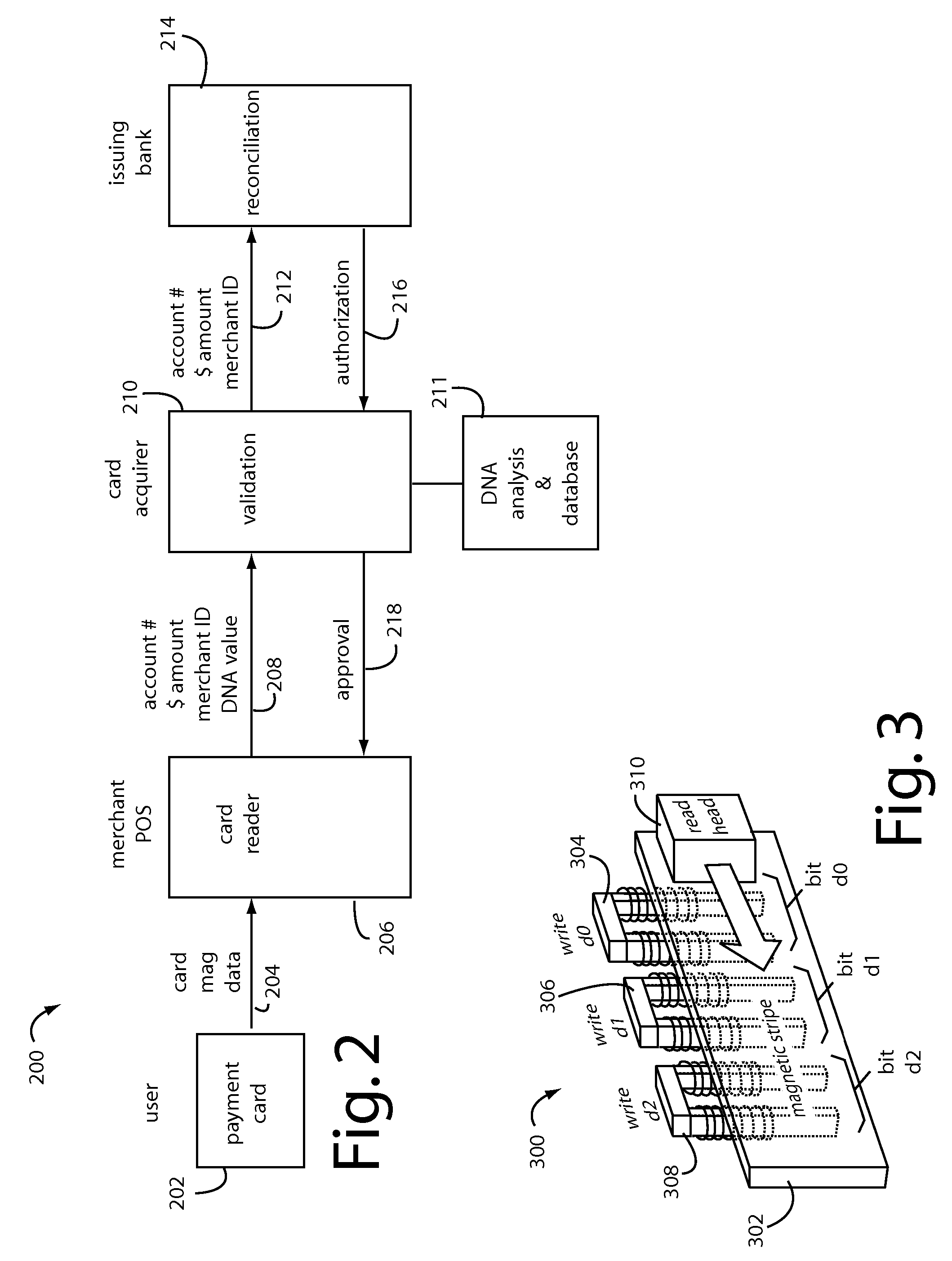

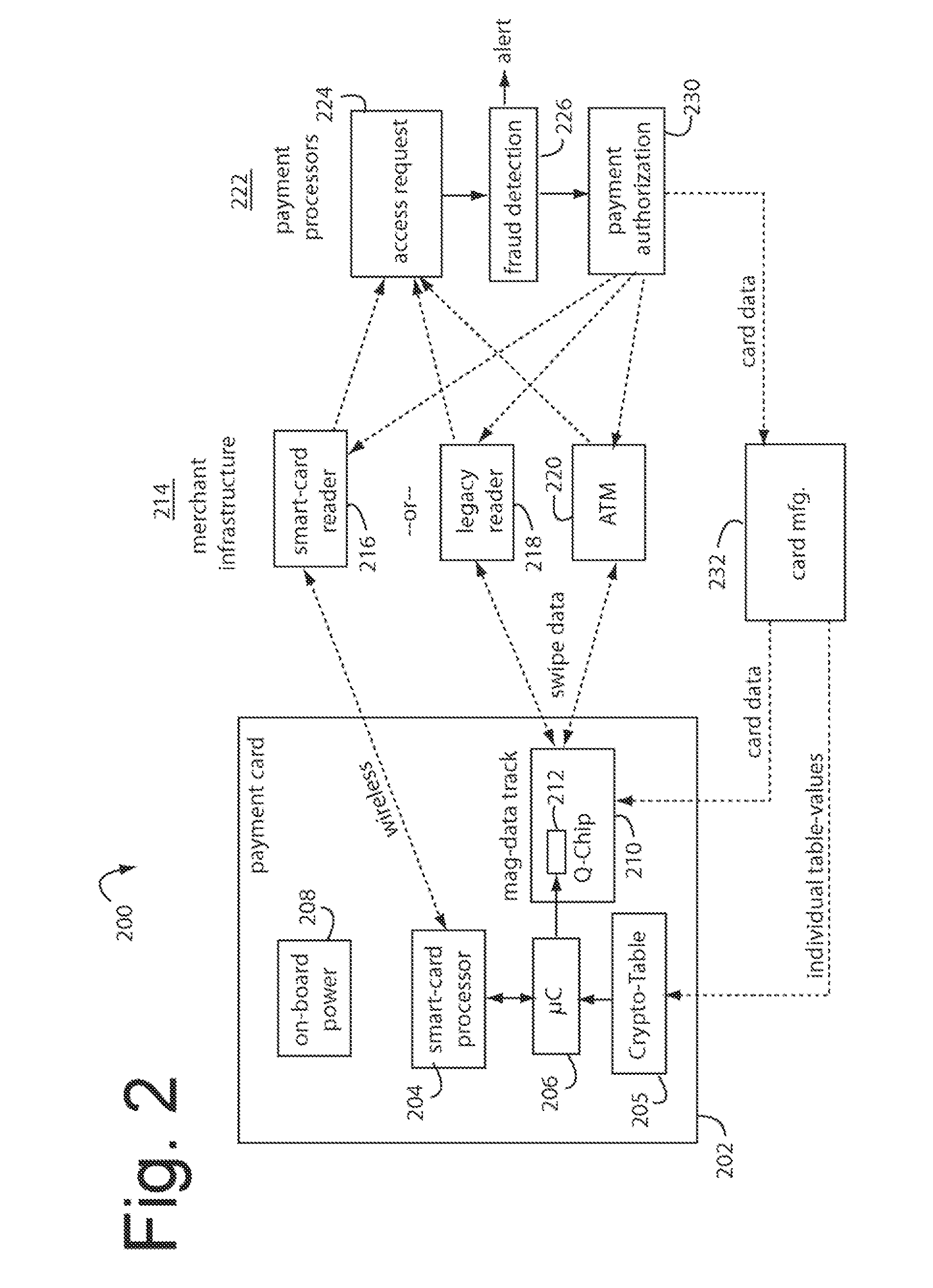

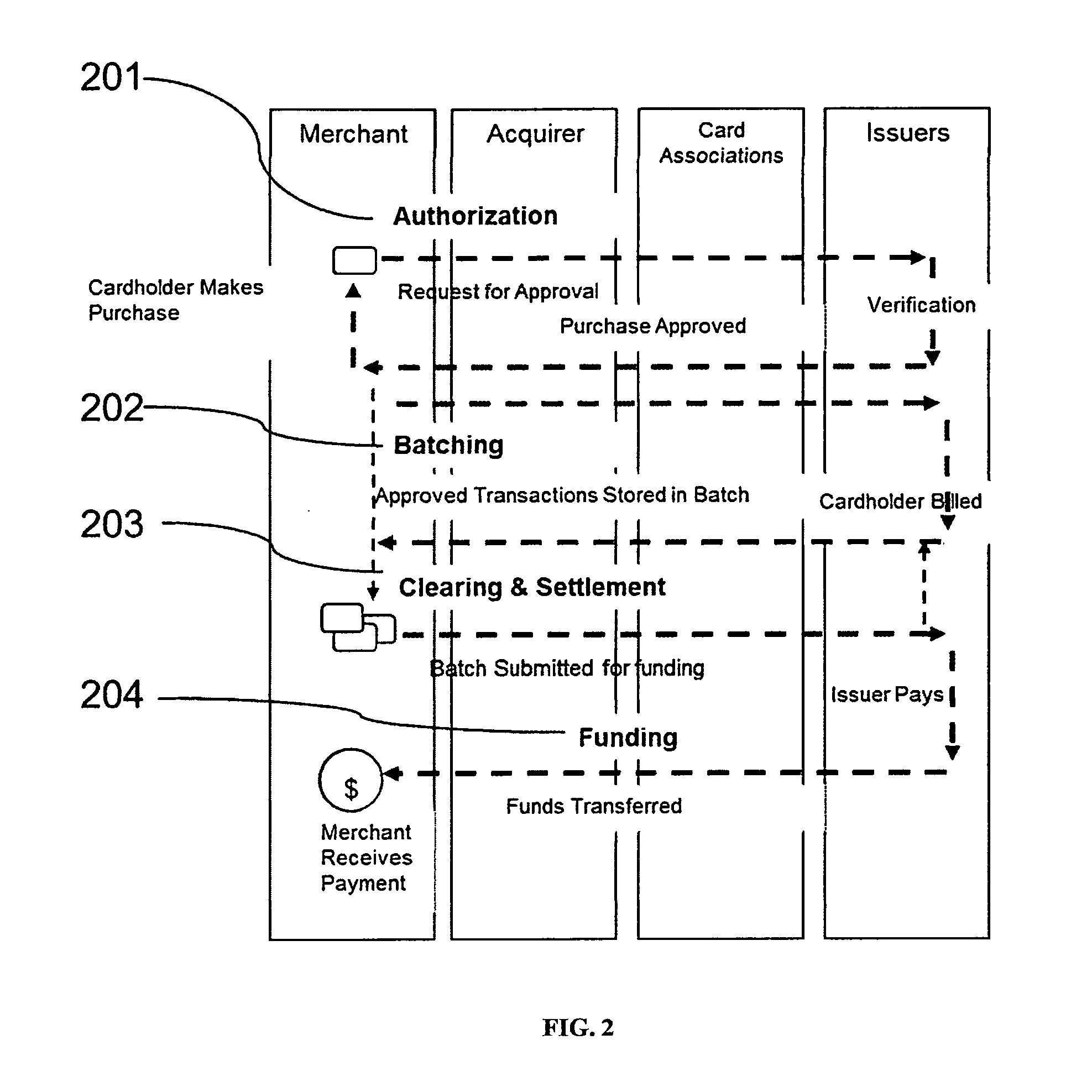

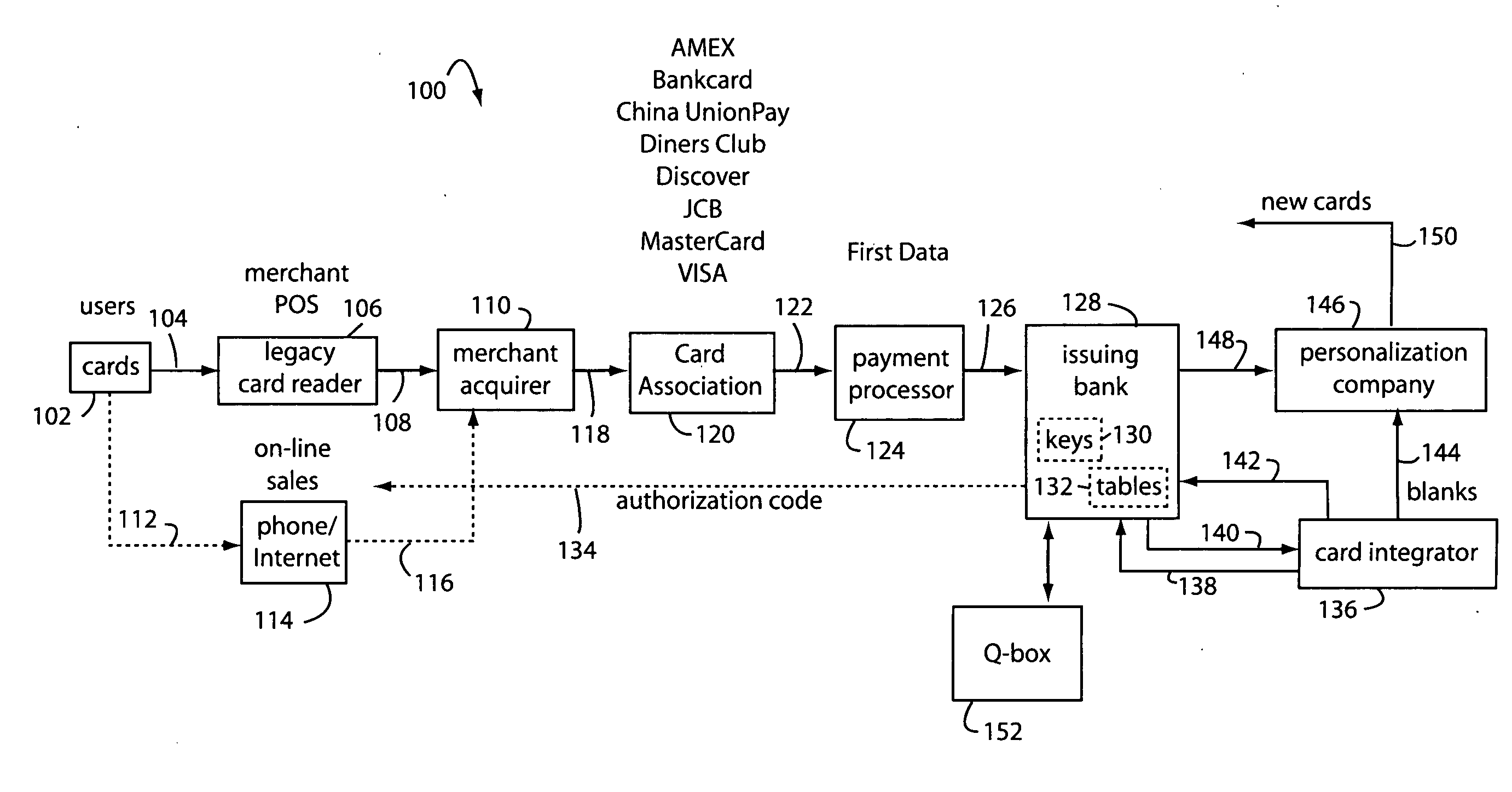

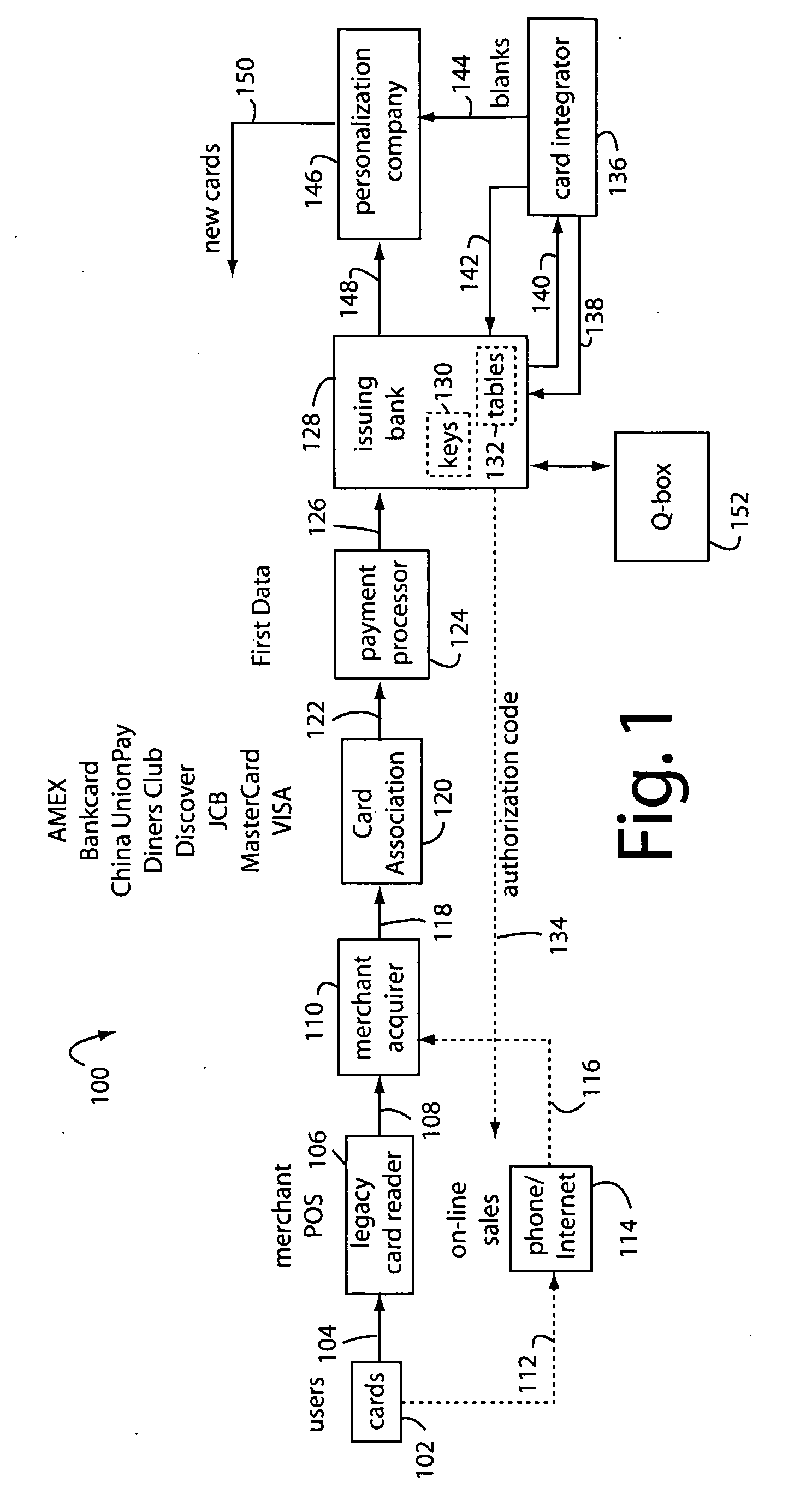

A method for securing financial transactions involving payment cards includes associating a sixteen-digit personal account number (PAN) with a particular payment card and user, wherein are included fields for a system number, a bank / product number, a user account number, and a check digit. A four-digit expiration date (MMYY) associated with the PAN. A magnetic stripe on the payment card is encoded with the PAN for periodic reading by a magnetic card reader during a financial transaction. A table of cryptographic values associated with the PAN and the MMYY is stored on each user's payment card during personalization by an issuing bank. A next financial transaction being commenced with the payment card is sensed. A cryptographic value from the table of cryptographic values is selected for inclusion as a dynamic portion of the user account number with the PAN when a next financial transaction is sensed. Any cryptographic value from the table of cryptographic values will not be used again in another financial transaction after being used once. The issuing bank authorizes the next financial transaction only if the PAN includes a correct cryptographic value in the user account number field.

Owner:FITBIT INC

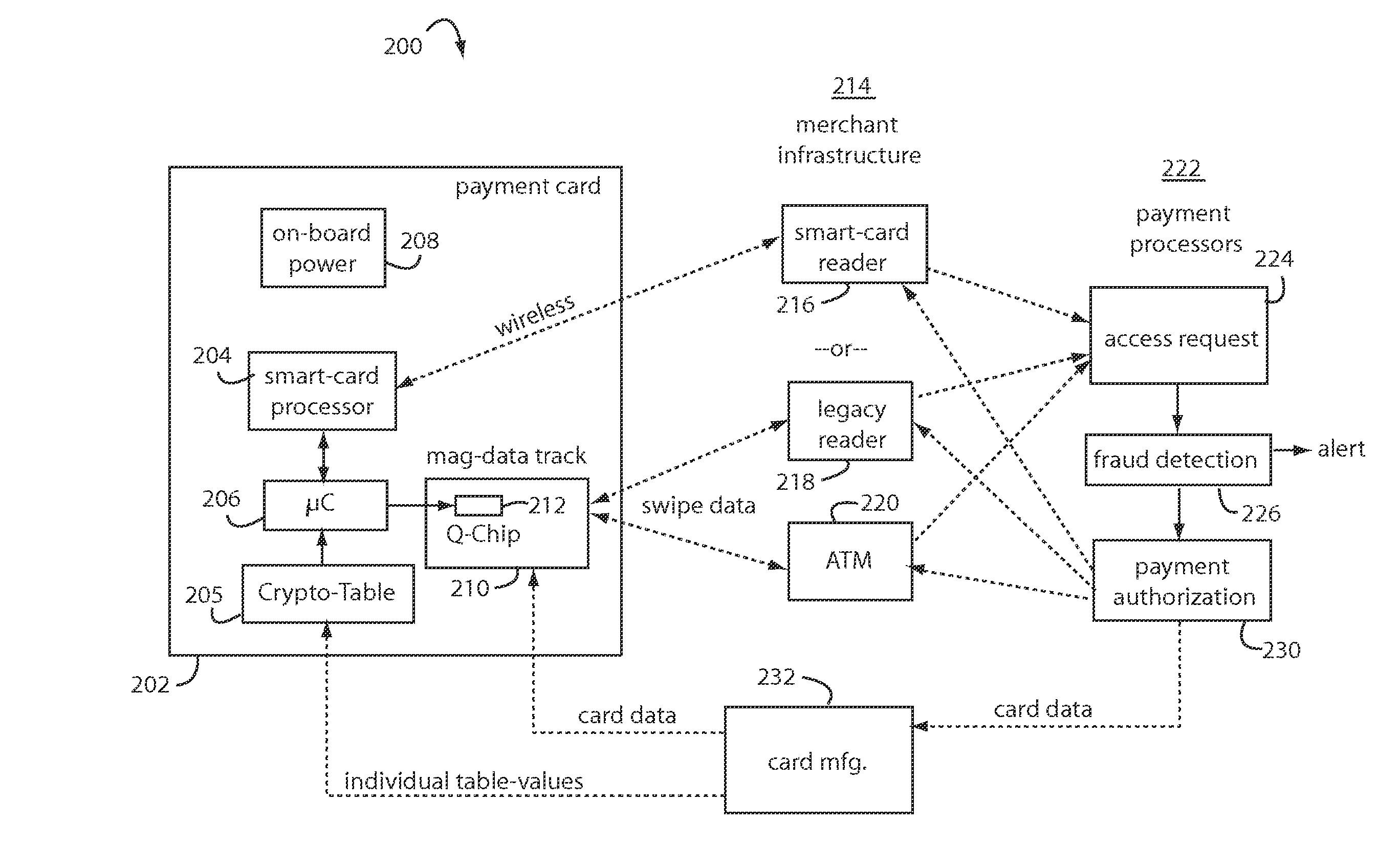

Payment card financial transaction authenticator

InactiveUS20080201264A1Sufficient dataAcutation objectsFinanceCryptographic nonceFinancial transaction

A payment card financial transaction authenticates for providing overall financial network security computes a number of results from a cryptographic key that match values that were selectively used to personalize individual payment cards with their individual user identification and account access codes. An account access code is later presented daring a financial transaction involving at least one of those individual payment cards. A dynamic portion is included in a merchant's magnetic reading of the payment card. Then authenication can proceed by matching it with values computed from the cryptographic key.

Owner:FITBIT INC

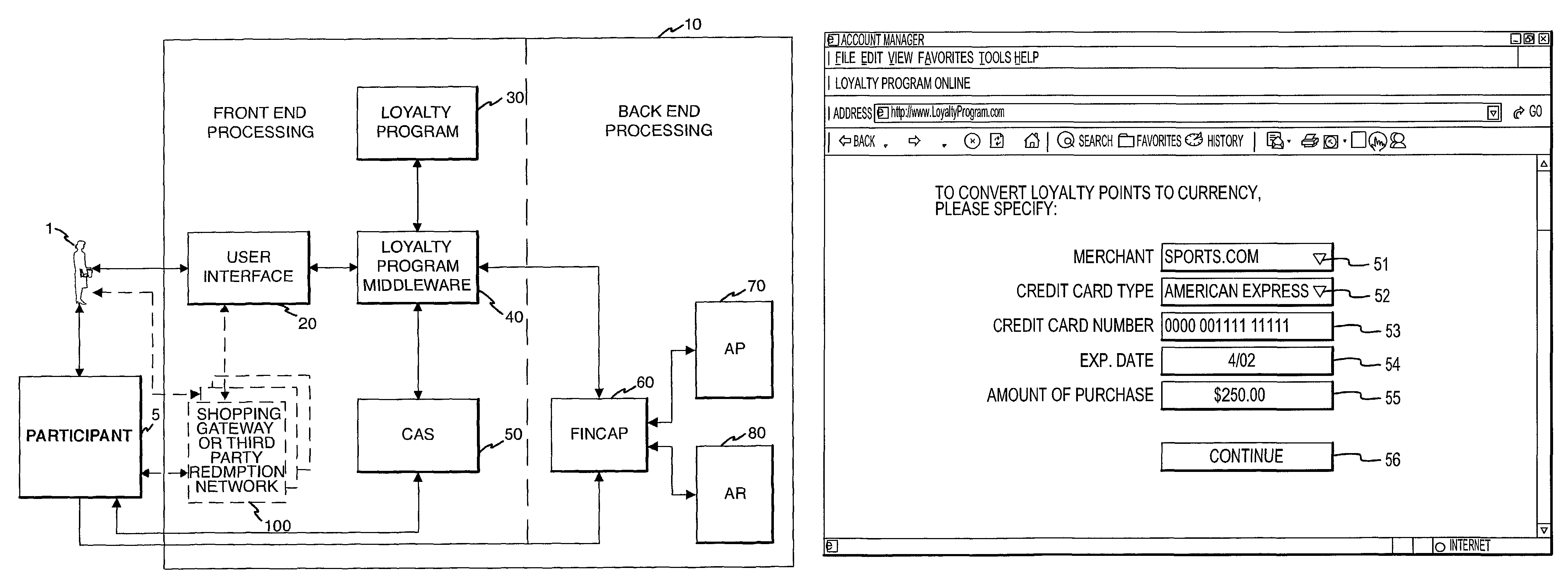

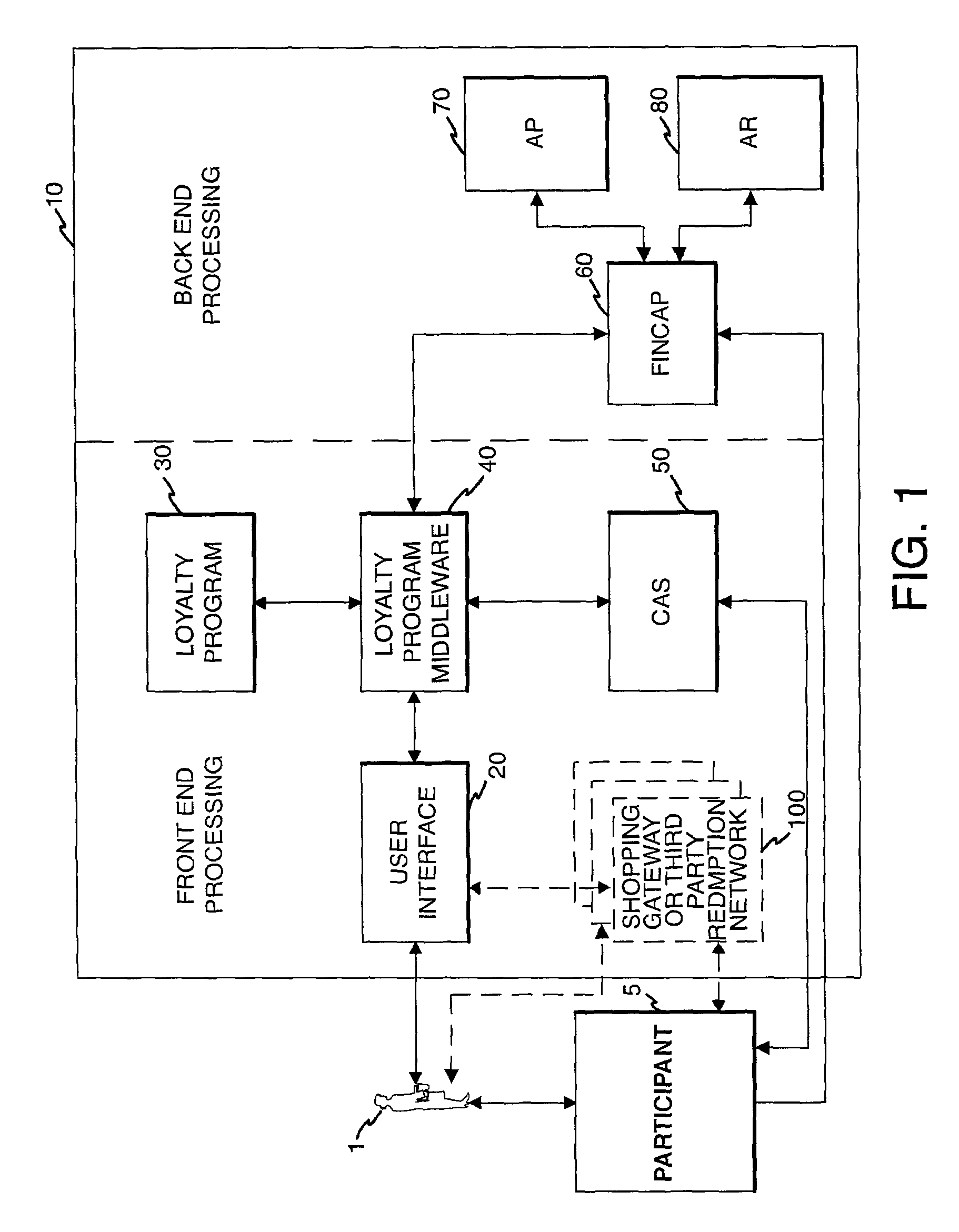

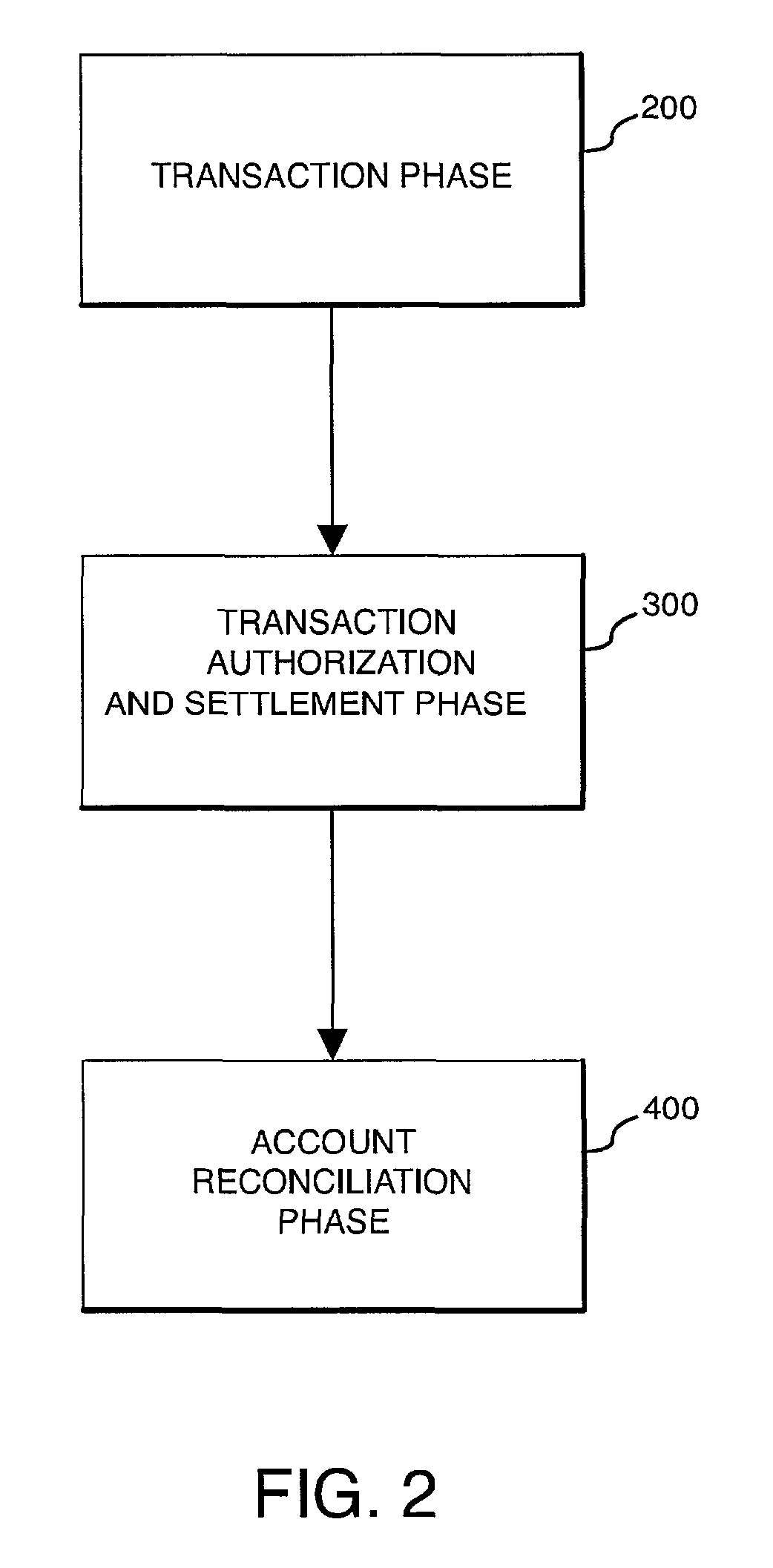

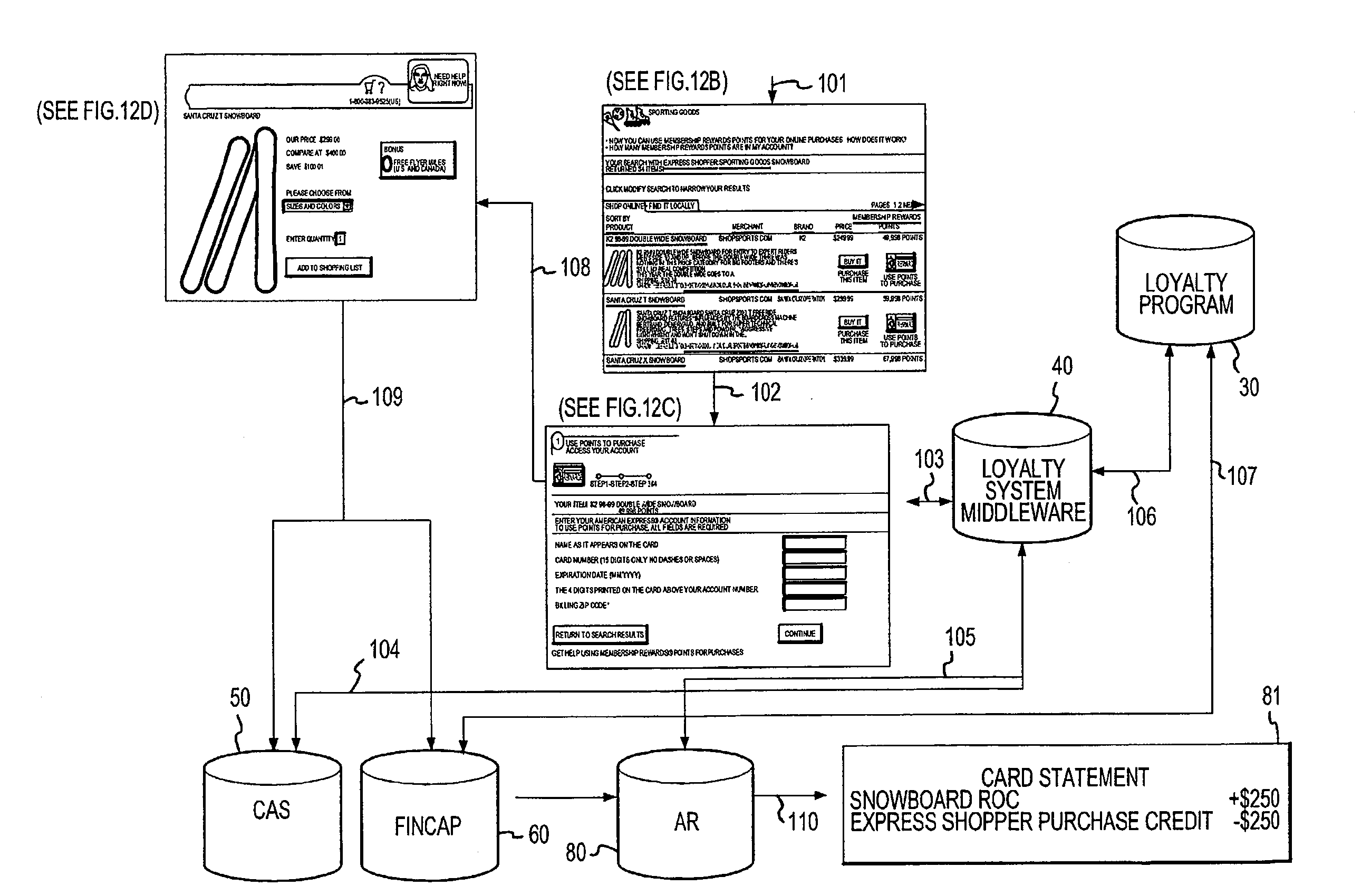

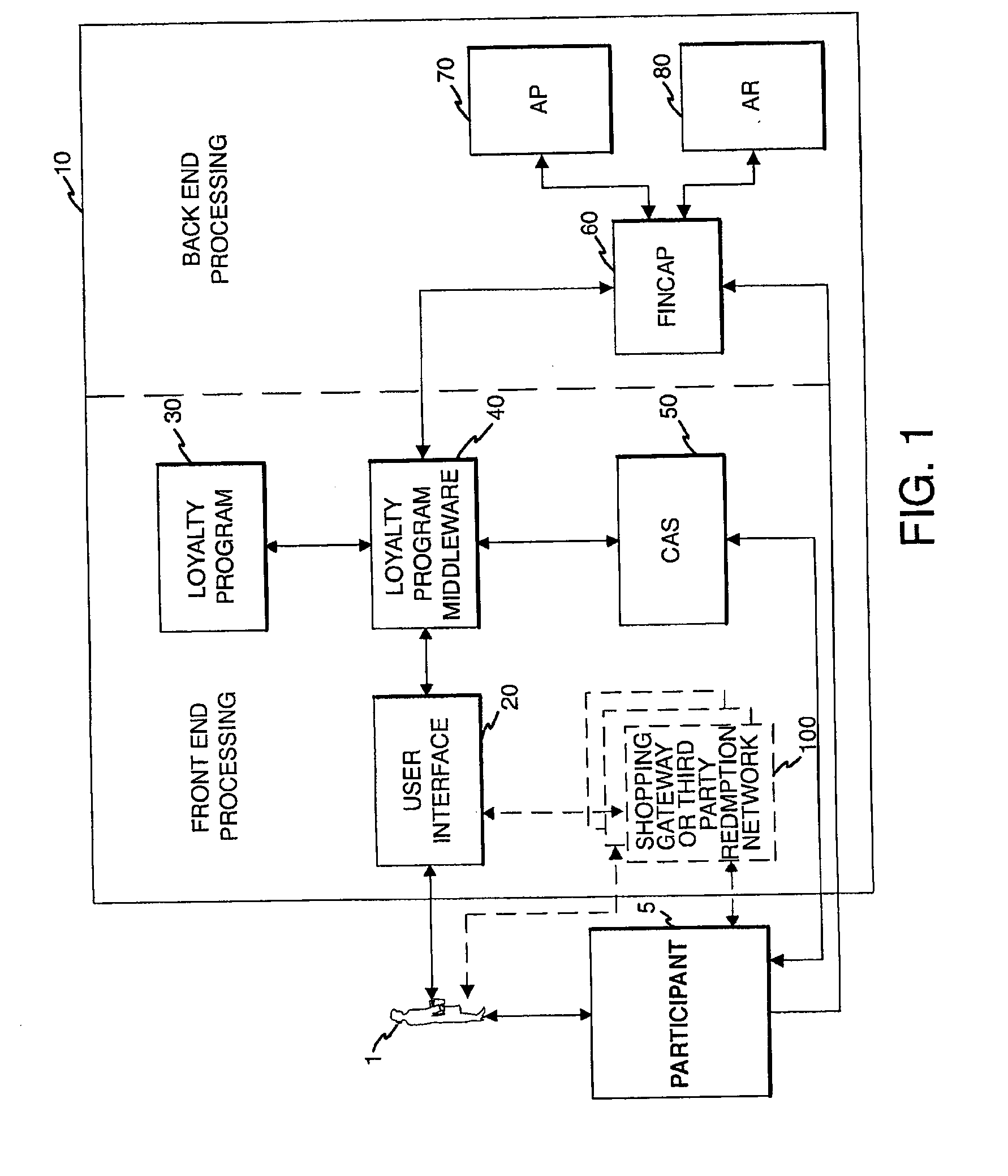

System and method for using loyalty rewards as currency

InactiveUS8046256B2Convenient transactionFinancePayment circuitsLoyalty programFinancial transaction

The present invention involves spending loyalty points over a computerized network to facilitate a transaction. With this system, a loyalty program participant is able to use an existing transaction card to purchase an item over a computerized network, while at the same time offsetting the cost of that transaction by converting loyalty points to a currency value credit and having the credit applied to the participant's financial transaction account. Currency credit from converted loyalty points may also be applied to stored value cards, online digital wallet accounts and the like. Further, currency credit may also be applied to other accounts to effect a gift or donation.

Owner:LIBERTY PEAK VENTURES LLC

Payment card preloaded with unique numbers

ActiveUS7380710B2Reduce financial riskSimple and inexpensive and effectiveFinancePayment architectureFinancial transactionPayment order

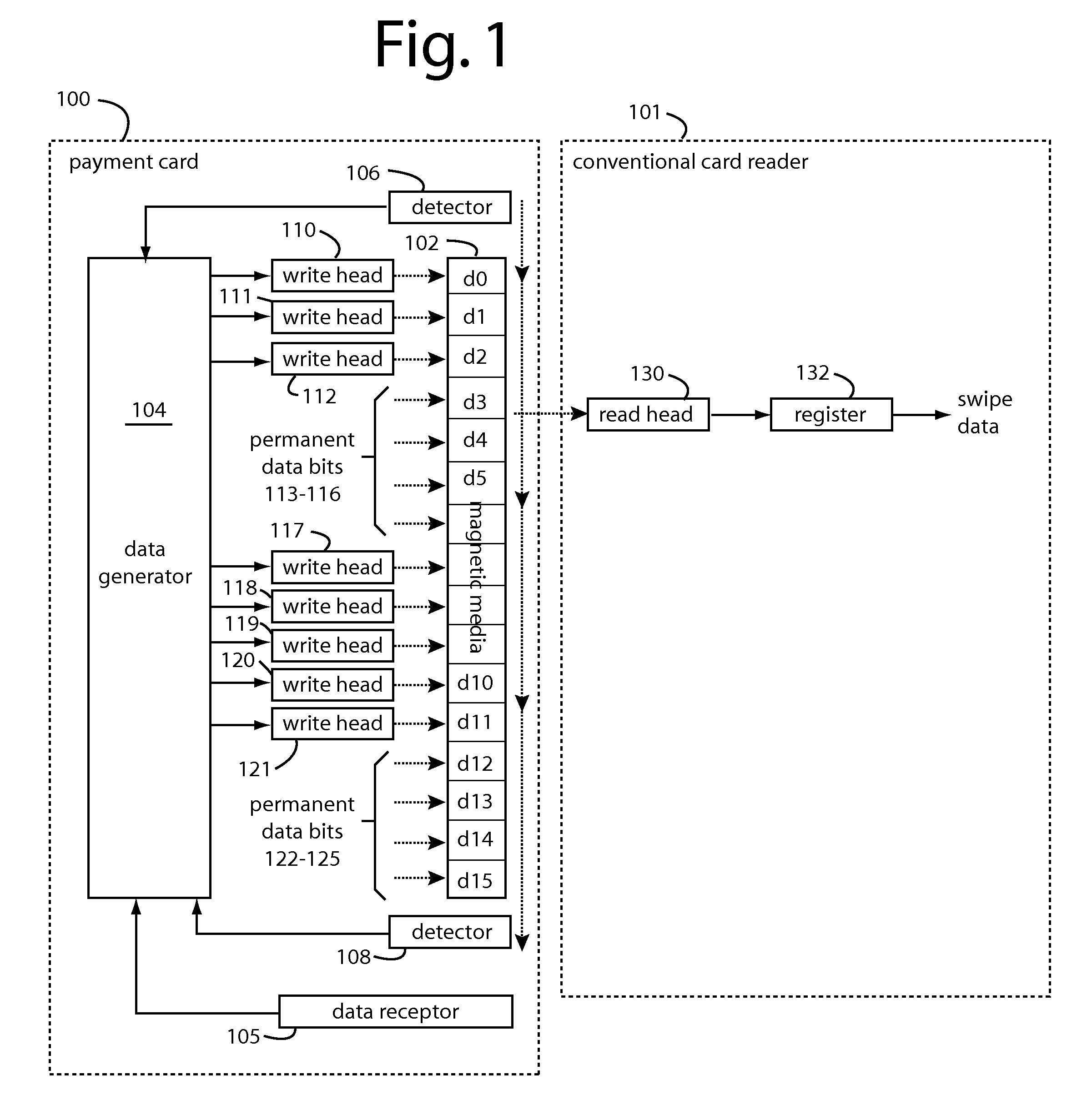

A conventional looking payment card comprises a plastic card with a legacy card reader compatible magnetic stripe for dynamic user account data. Internal to the plastic card, and behind the magnetic stripe, a number of fixed-position magnetic write heads allow the user account data to be modified autonomously. Electronics within the card are pre-loaded with many unique numbers that are selected for one-time use in financial transactions. A payment processing center keeps track of the unique numbers used, and knows which numbers to expect in future transactions. It will not authorize transaction requests if the unique number read during a magnetic card swipe is not as expected. A card-swipe detector embedded in the plastic card detects each use in a scanner, so changes can be made to the data bits sent to the write heads.

Owner:FITBIT INC

Group peer-to-peer financial transactions

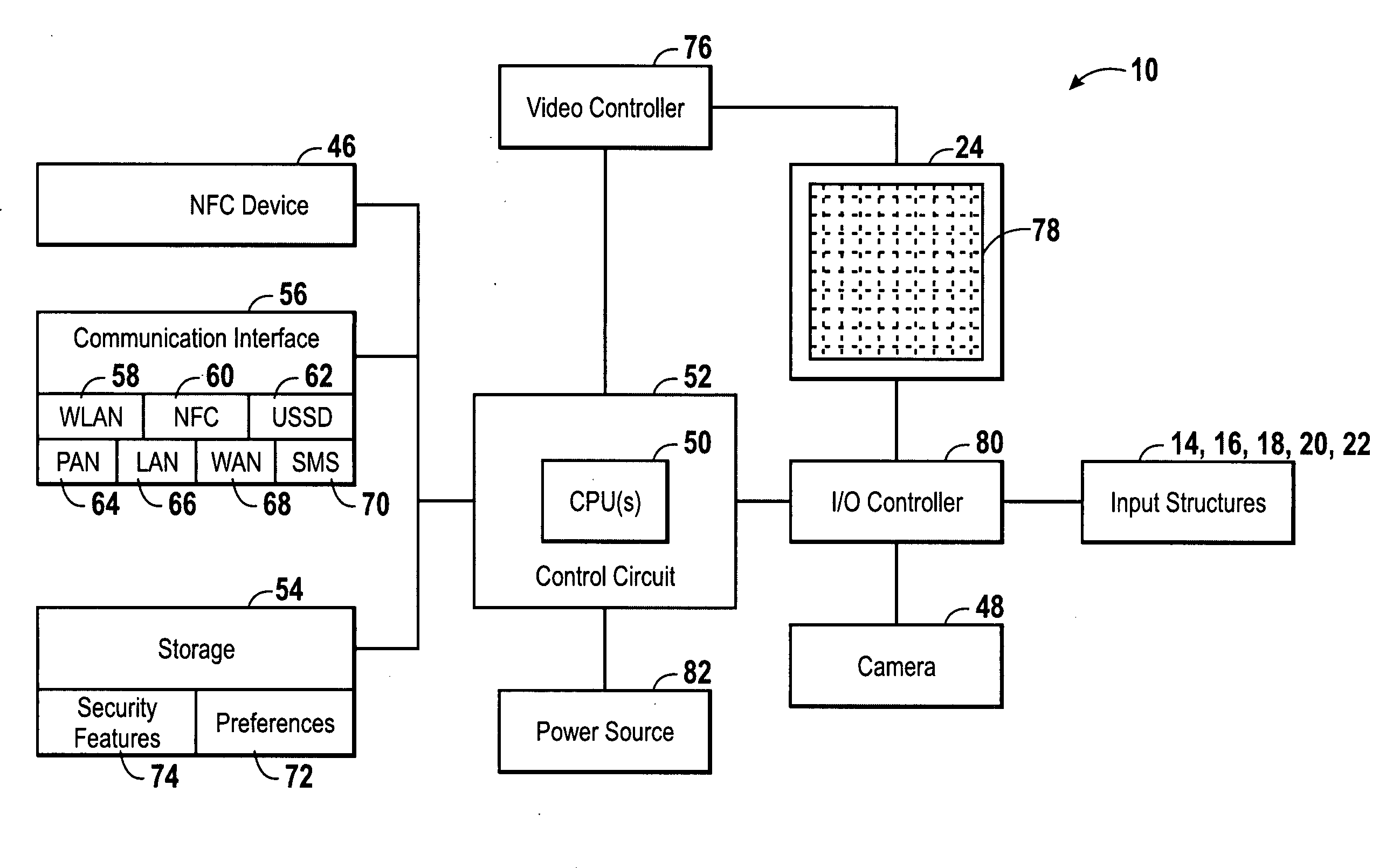

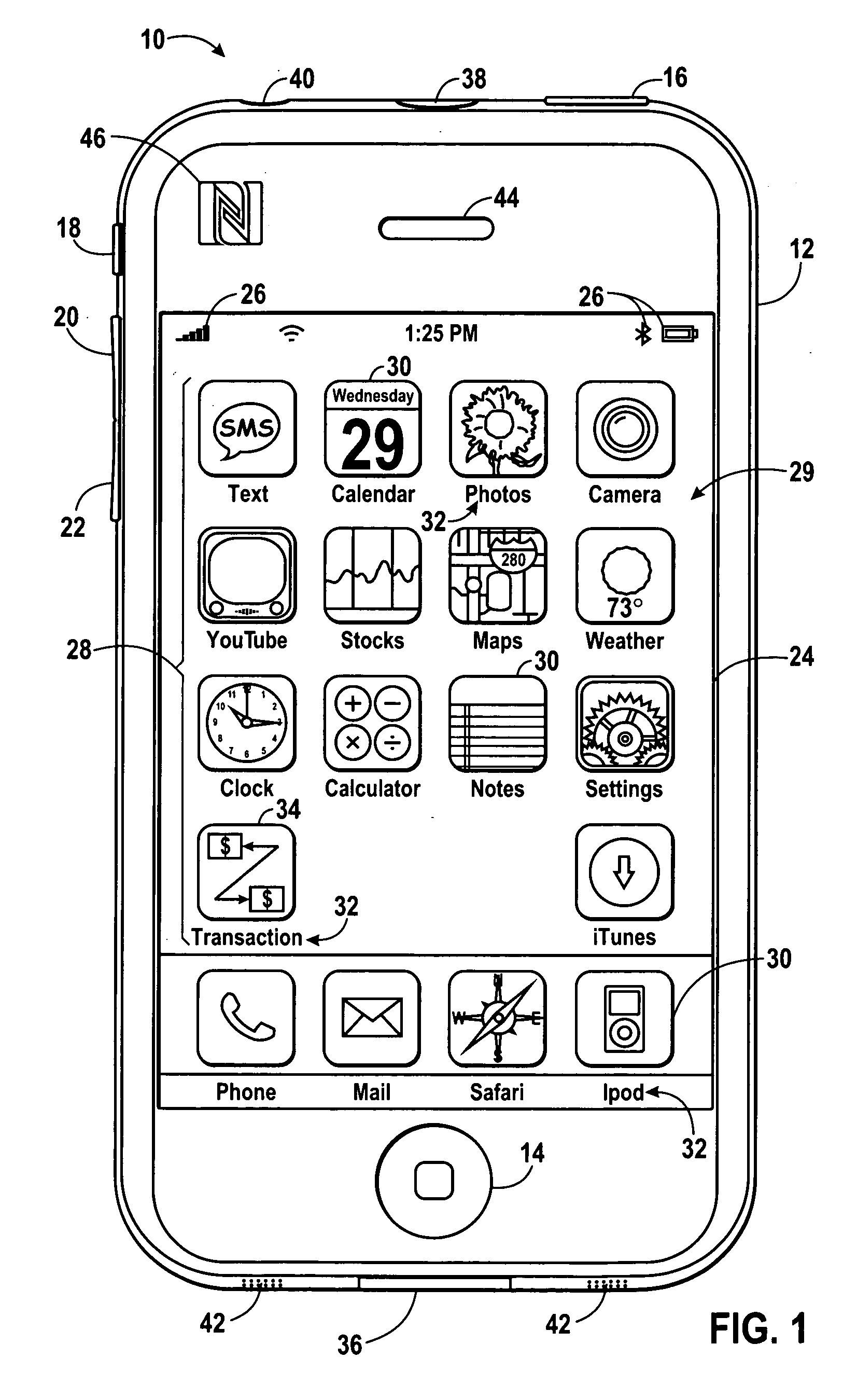

Various techniques are provided for carrying out peer-to-peer financial transactions using one or more electronic devices. In one embodiment, a request for payment is transmitted from a first device to a second device using a near field communication (NFC) interface. In response to the request, the second device may transmit payment information to the first device. The first device may select a crediting account and, using a suitable communication protocol, may communicate the received payment information and selected crediting account to one or more external financial servers configured to process and determine whether the payment may be authorized. If the payment is authorized, a payment may be credited to the selected crediting account. In a further embodiment, a device may include a camera configured to obtain an image of a payment instrument. The device may further include an application to extract payment information from the acquired image.

Owner:APPLE INC

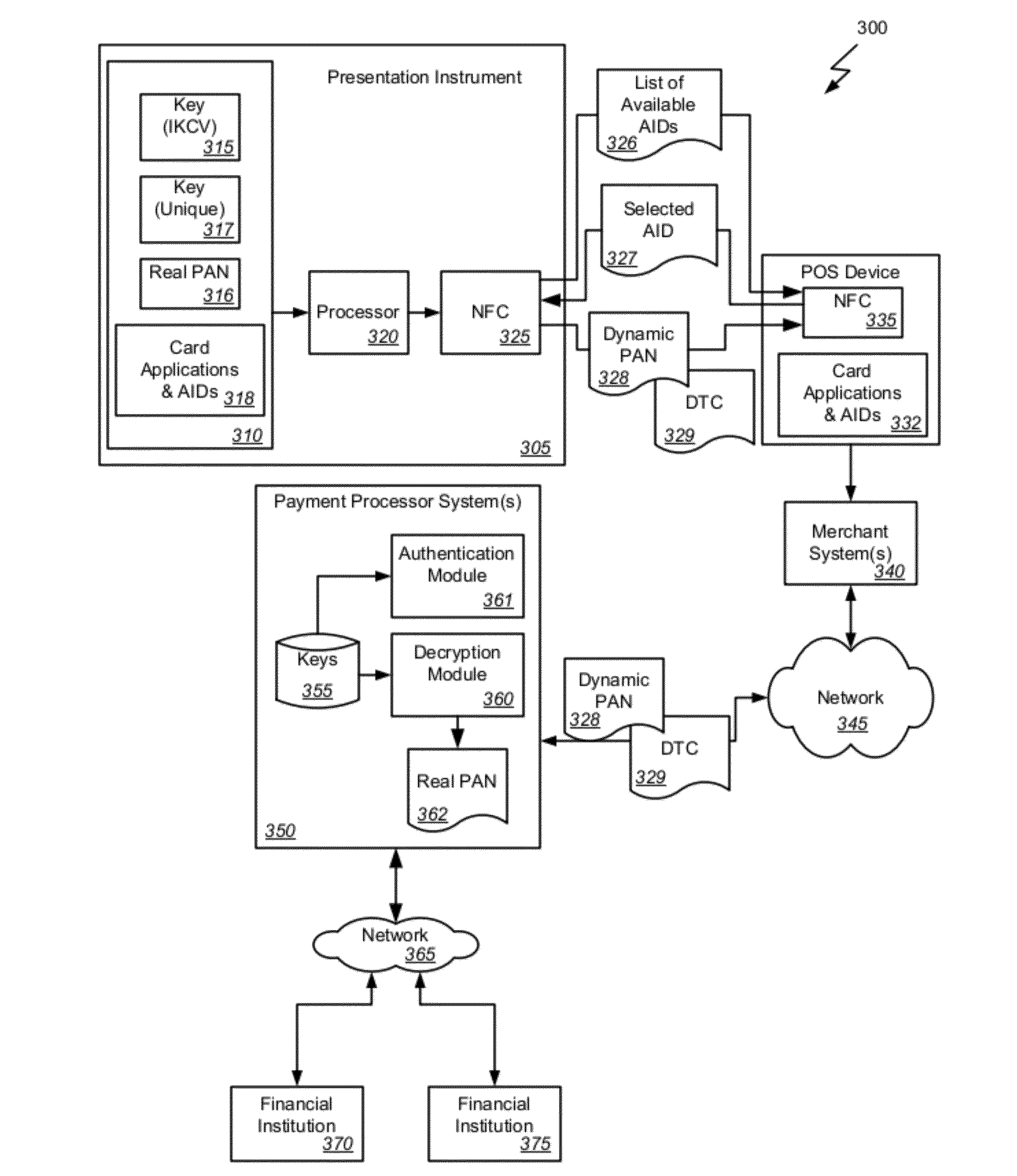

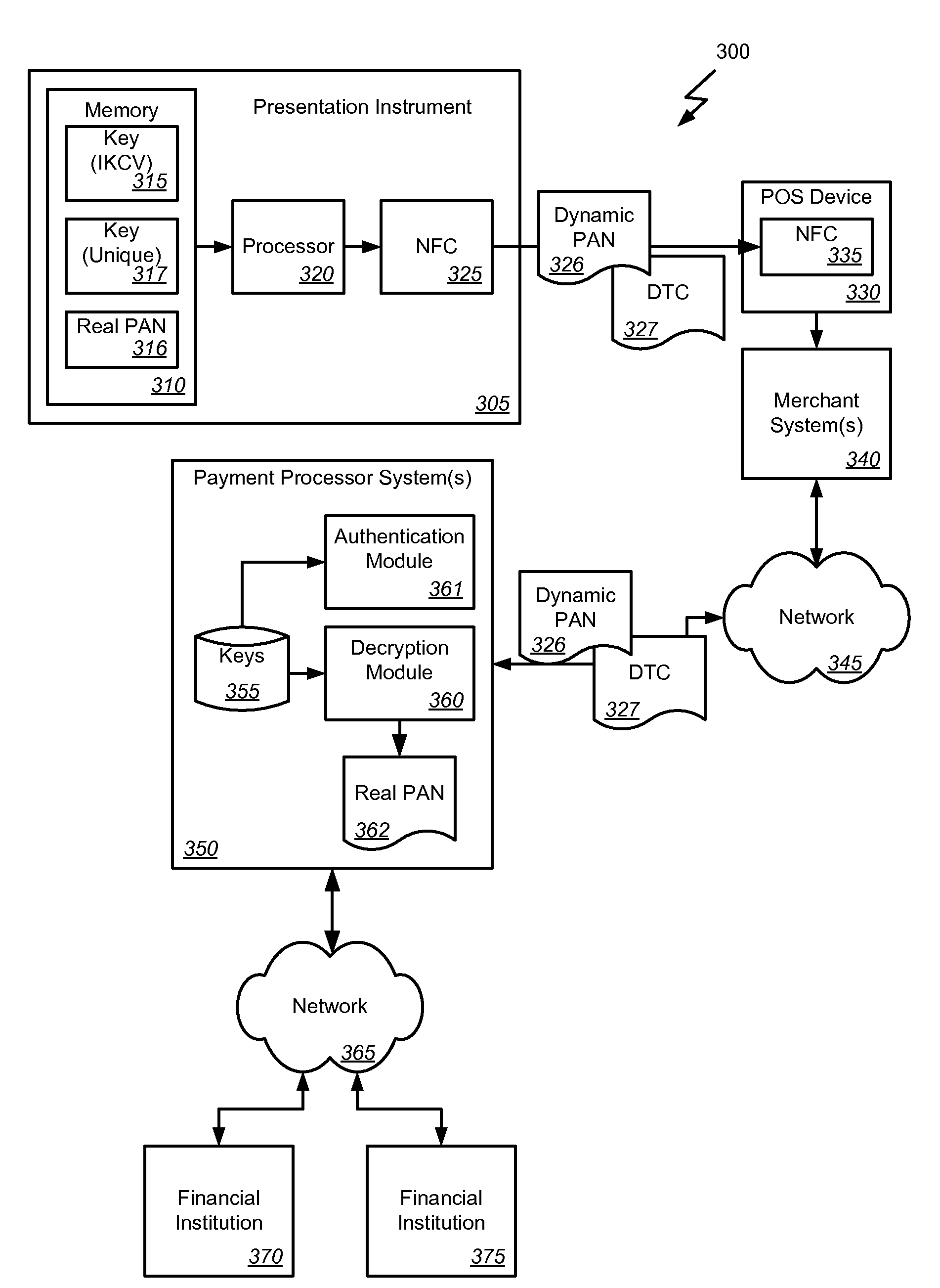

Processing transactions with an extended application id and dynamic cryptograms

Methods, systems, and machine-readable media are disclosed for handling information related to a transaction conducted with a presentation instrument at a POS device. Extended application IDs and dynamic cryptograms are use for the transaction. According to one embodiment, a method of processing a financial transaction for an account having a primary account number (PAN) can comprise detecting initiation of the transaction with the presentation instrument, and providing from the presentation instrument to the POS device a list of one or more applications IDs. Each application ID identifies an application that can be used to communicate data concerning the transaction between the presentation instrument and the POS device. The POS device selects one of the application IDs and returns it to the presentation instrument. Under the control of the selected application, the presentation instrument generates a Dynamic Transaction Cryptogram (DTC) and a dynamic PAN that are each valid for only a single transaction.

Owner:FIRST DATA

Financial transaction payment processor

InactiveUS20090006262A1Sufficient dataAcutation objectsSynchronising transmission/receiving encryption devicesPayment orderFinancial transaction

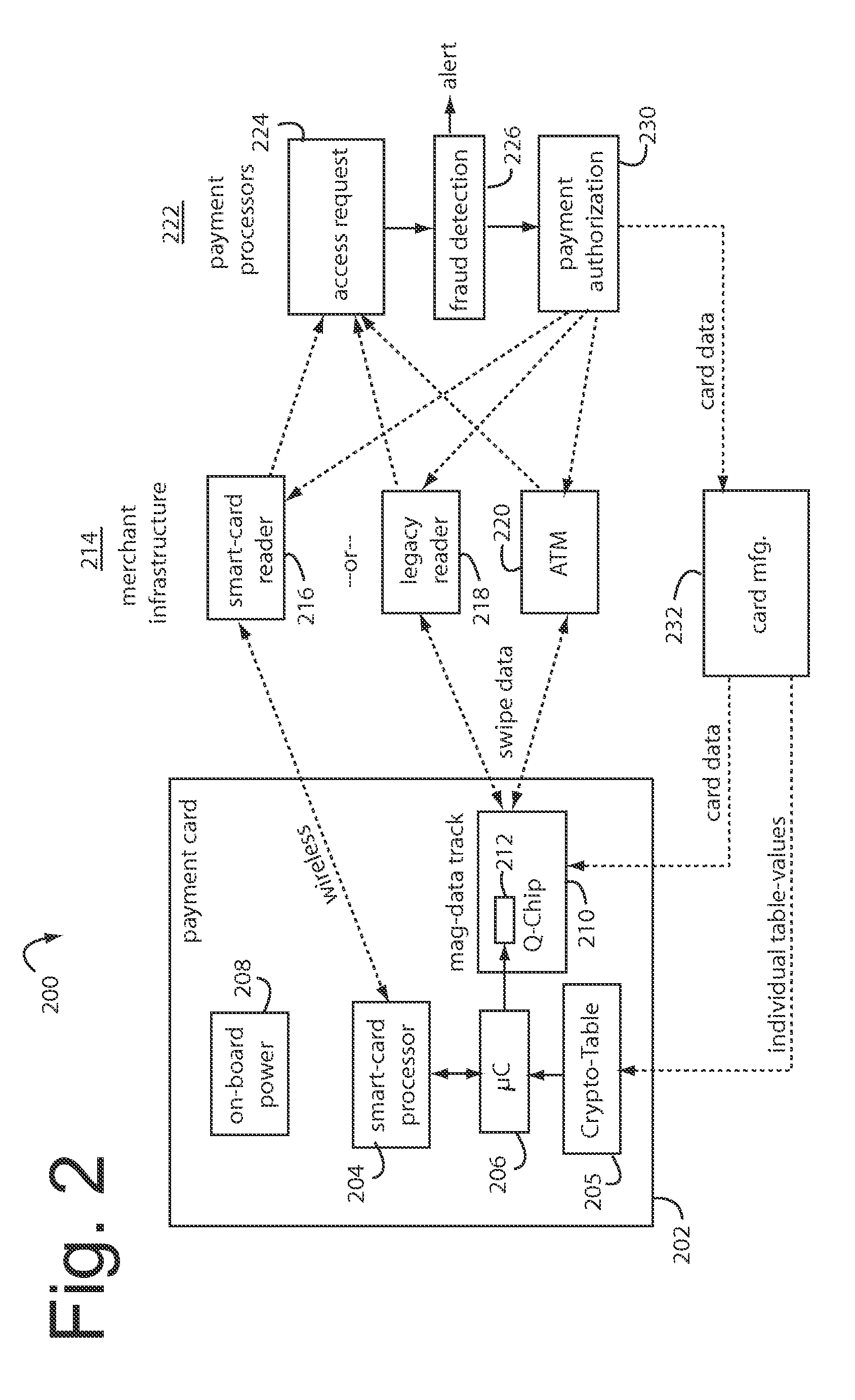

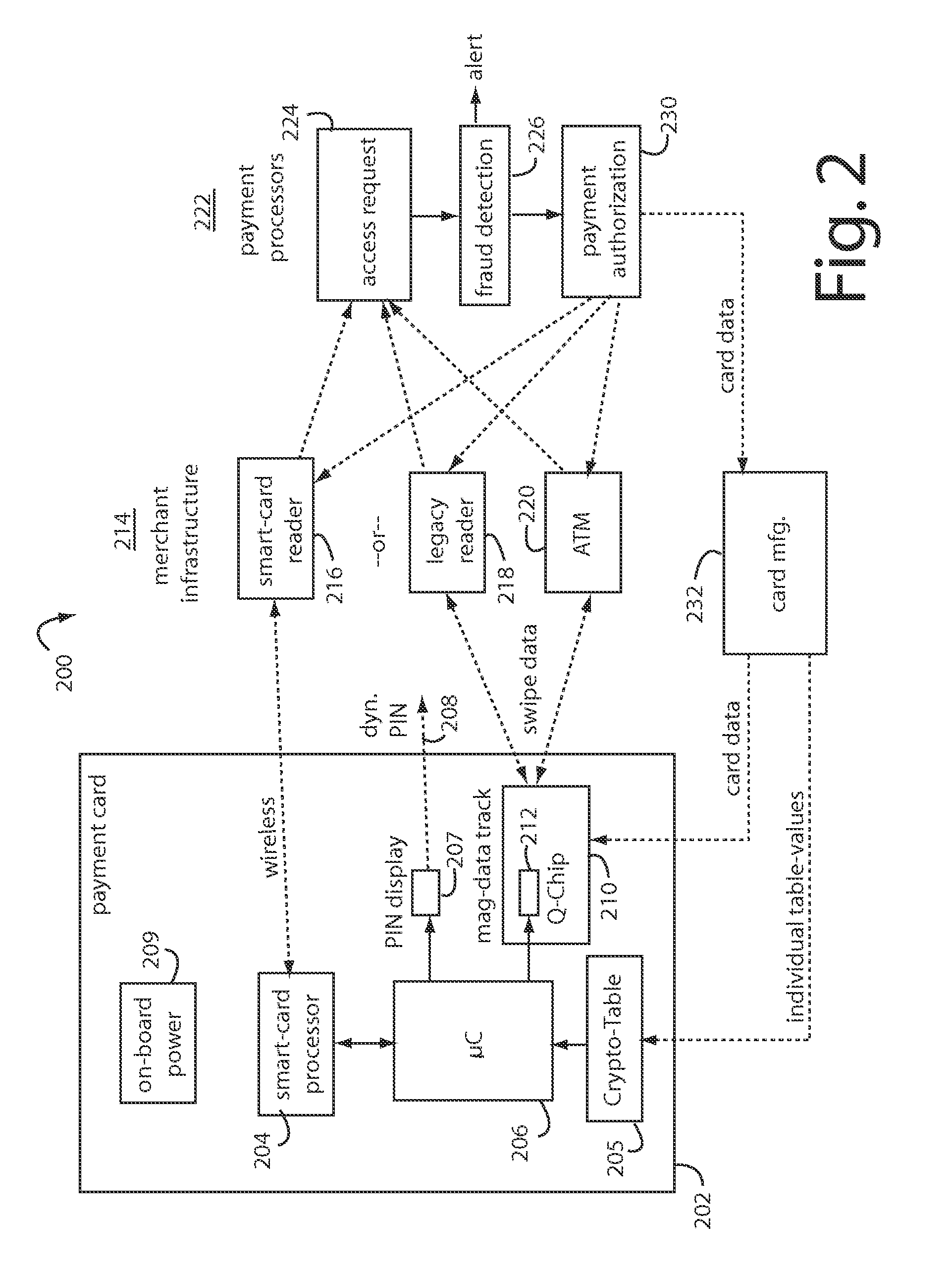

A financial transaction payment processor includes an account access request processor for receiving dynamic swipe data from a payment card through a merchant infrastructure. A fraud detection processor is connected to analyze a dynamic data obtained by the account access request processor that should agree with values pre-loaded in a Crypto-Table by a card manufacturer. A payment authorization processor is connected to receive a message from the fraud detection processor and to then forward a response to the merchant infrastructure.

Owner:FITBIT INC

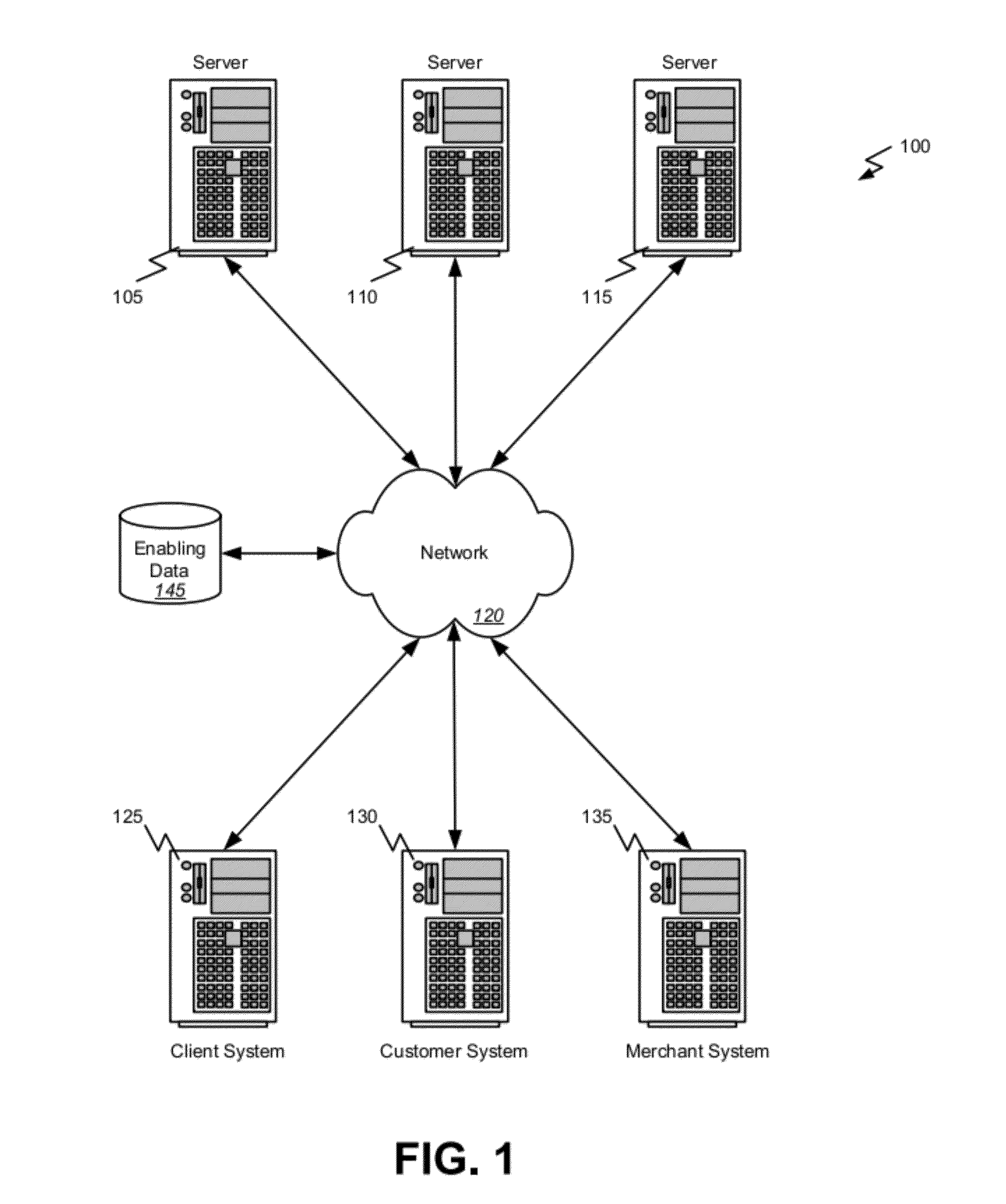

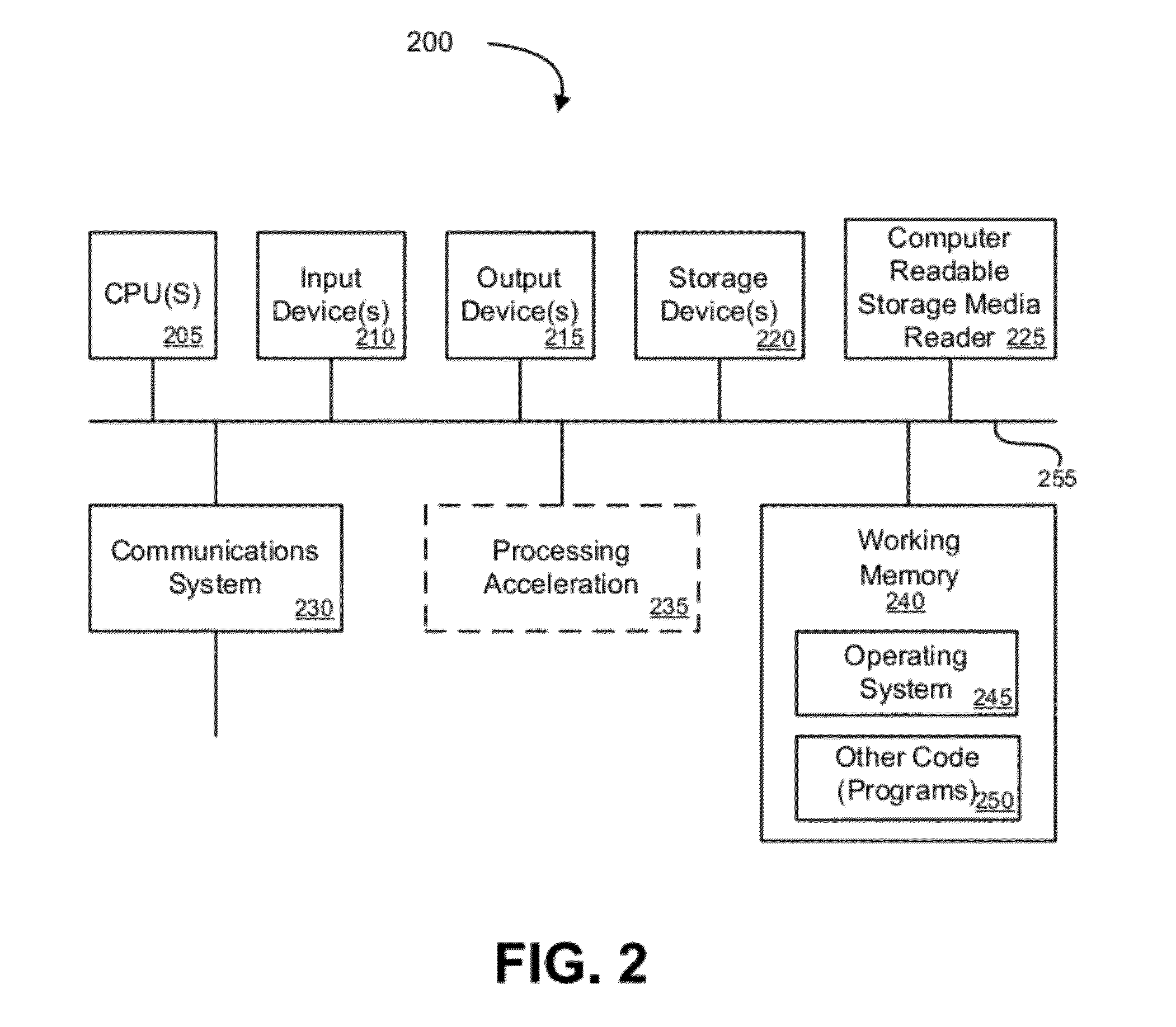

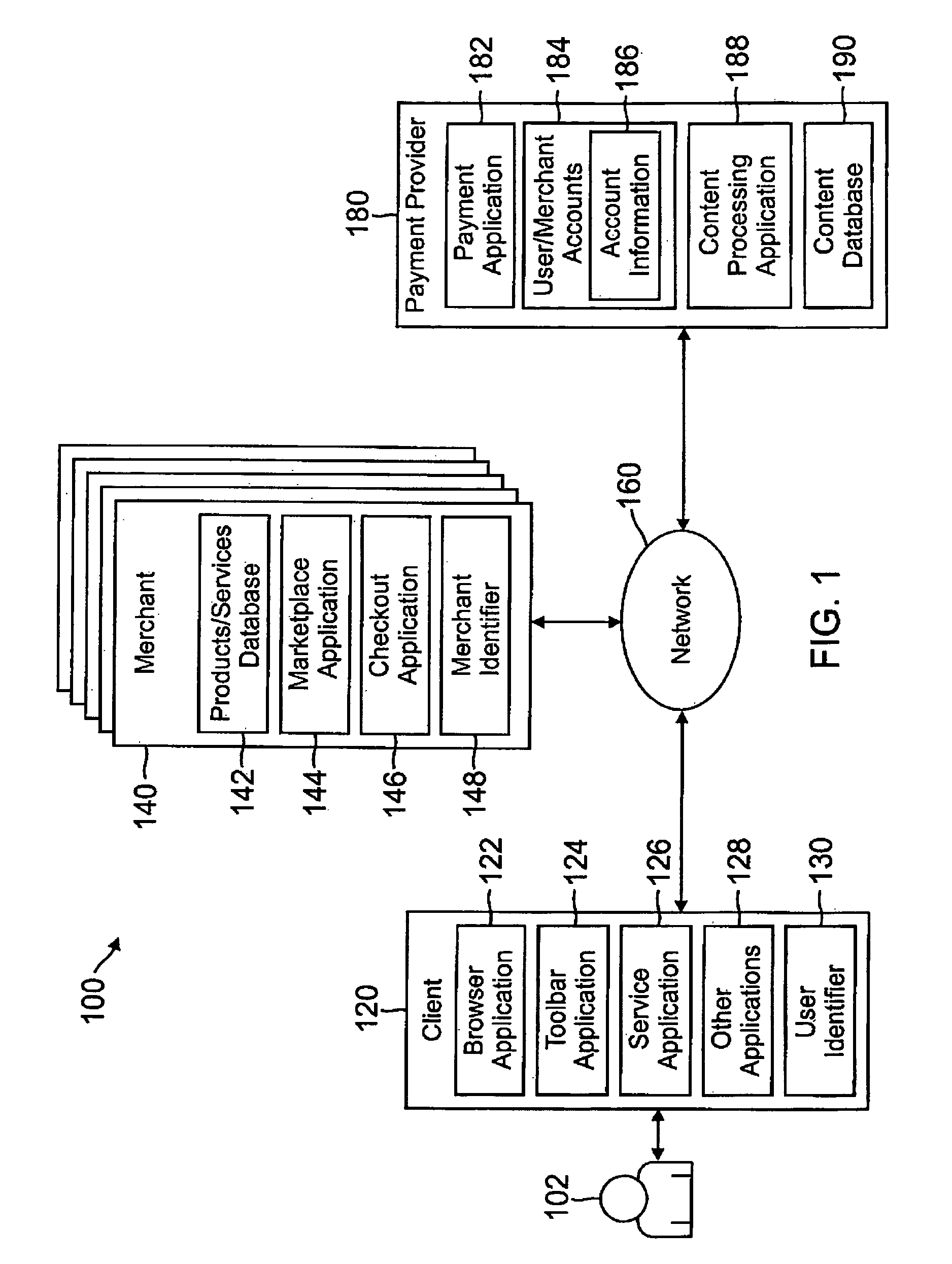

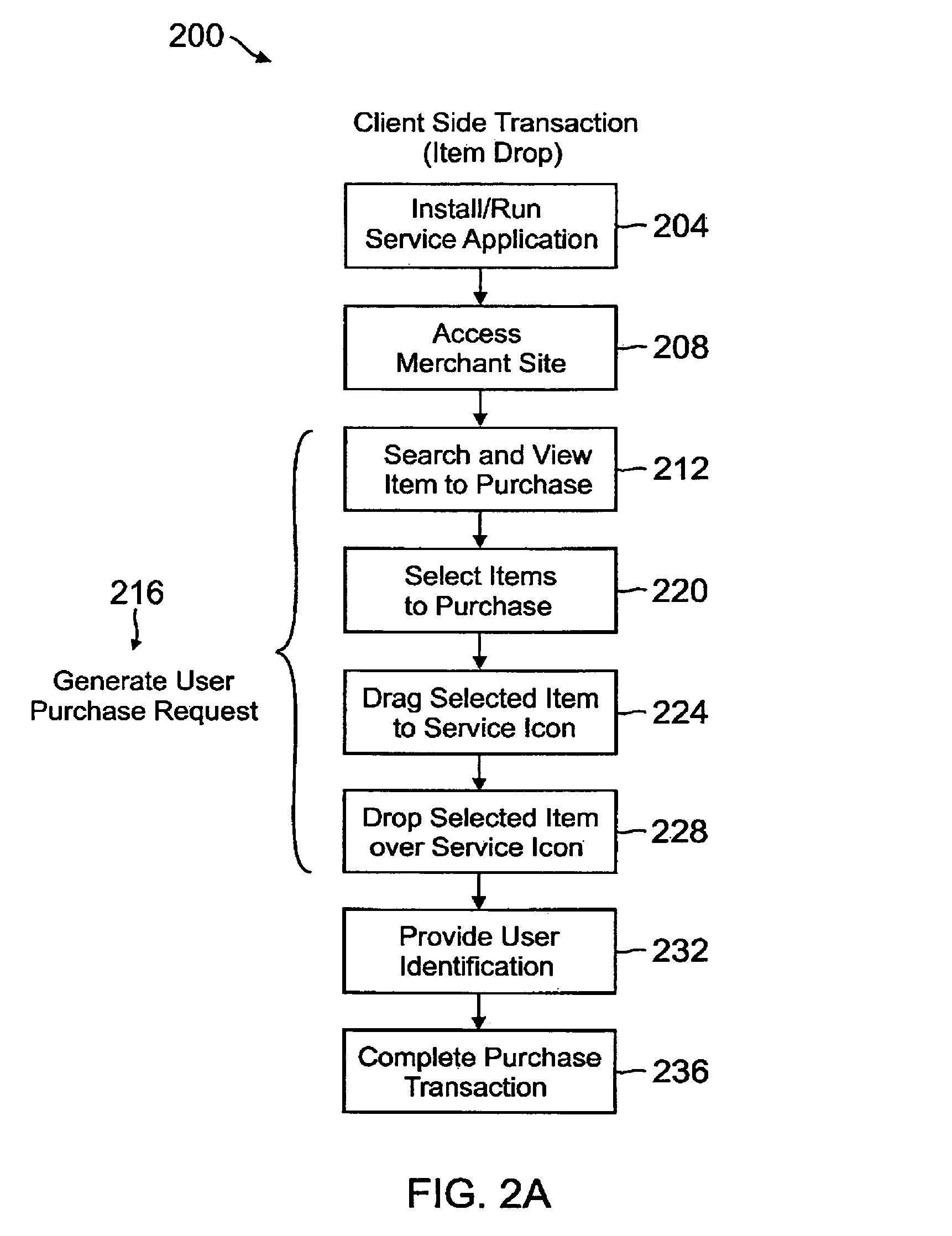

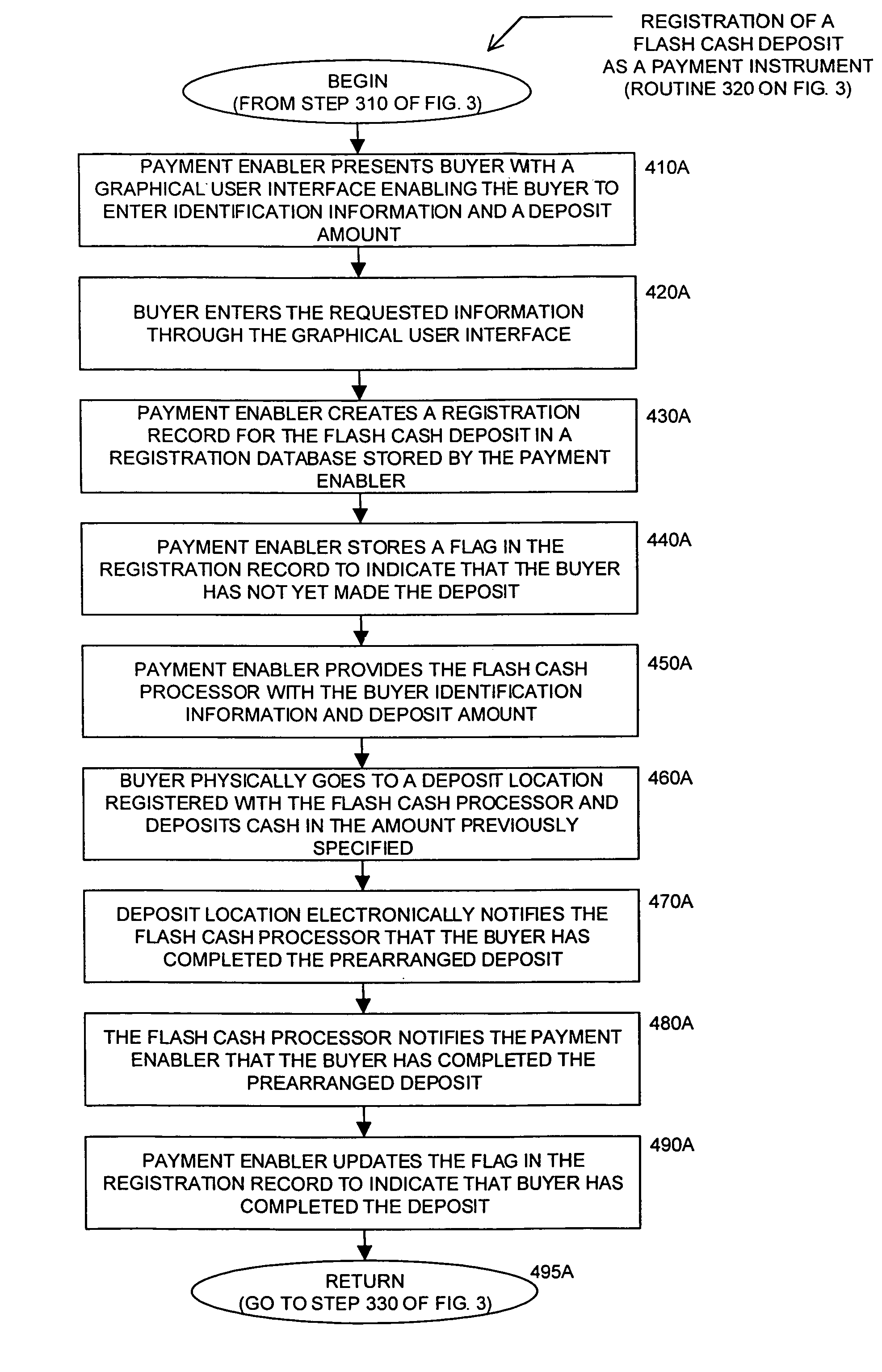

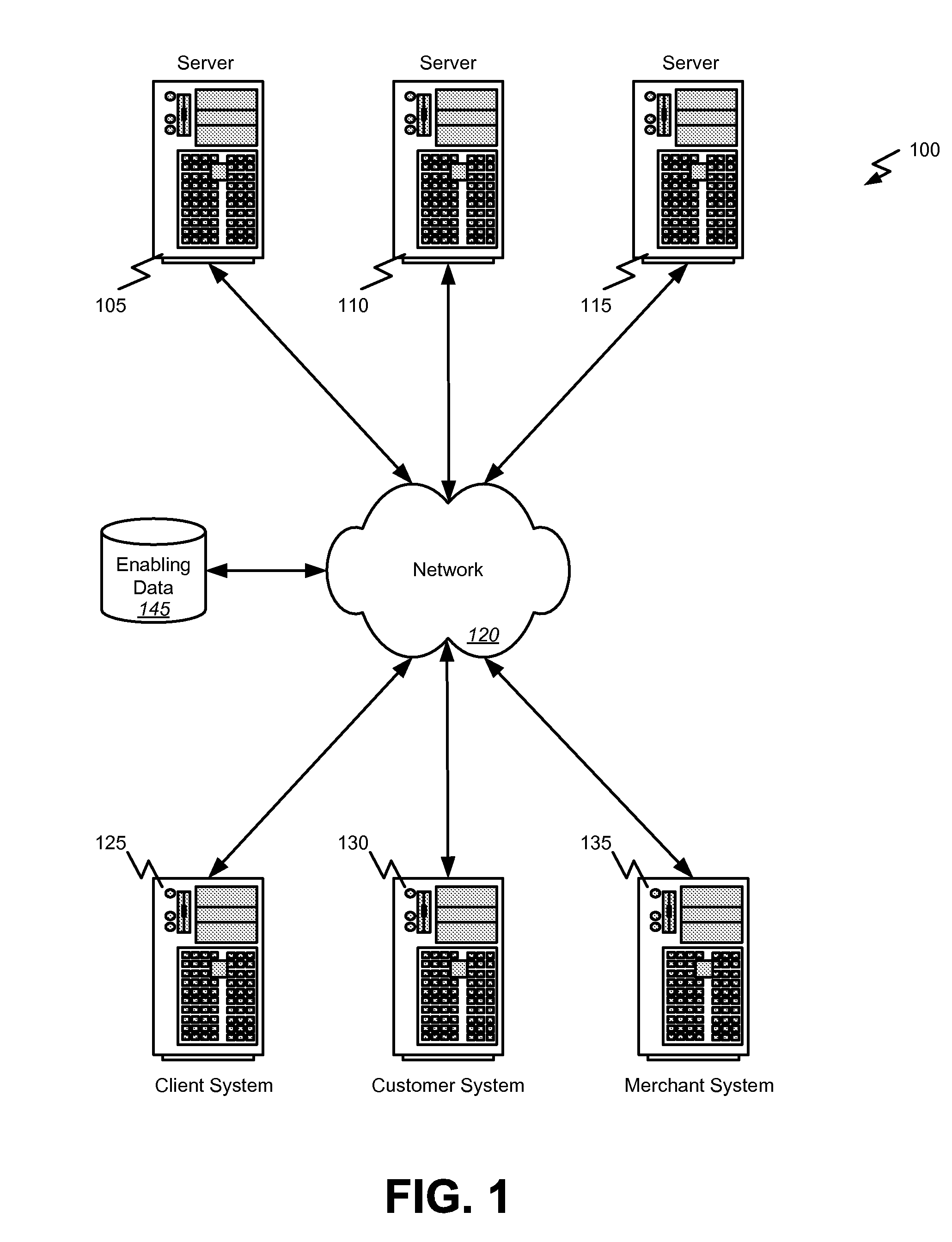

Systems and methods for facilitating financial transactions over a network

Systems and methods for facilitating financial transactions over a network include a merchant device, a client device and a payment processing device. The merchant device is adapted to allow a merchant to provide items for purchase via the network. The client device is adapted to allow a user to access the merchant device via the network and view the items for purchase. The client device is adapted to provide a payment mechanism to the user. The user generates a purchase request for an item by selecting the one item, dragging the item to the payment mechanism, and dropping the item over the payment mechanism. The payment processing device is adapted to receive the purchase request from the client device via the network and authorize the user to purchase the item from the merchant based on information passed with the purchase request.

Owner:PAYPAL INC

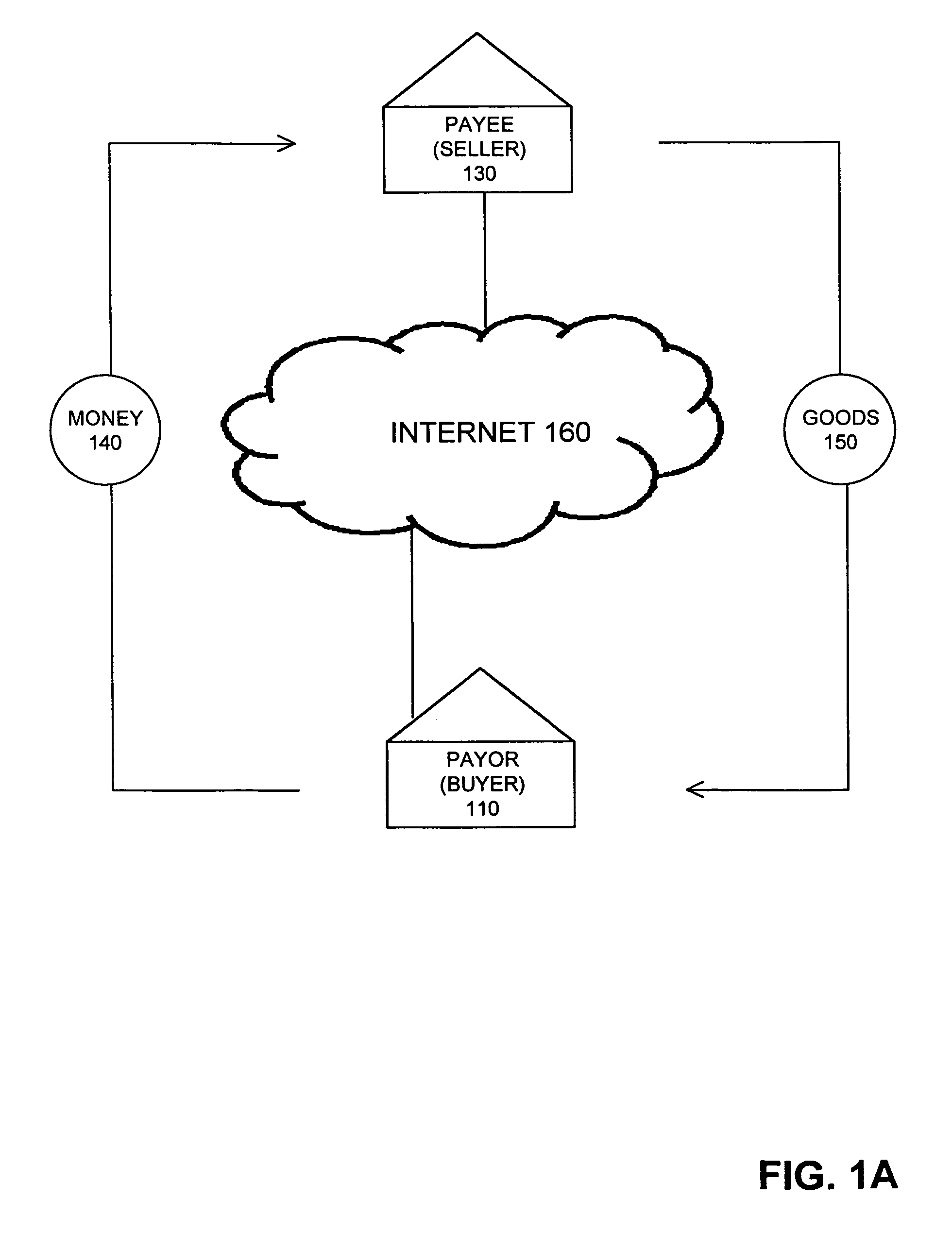

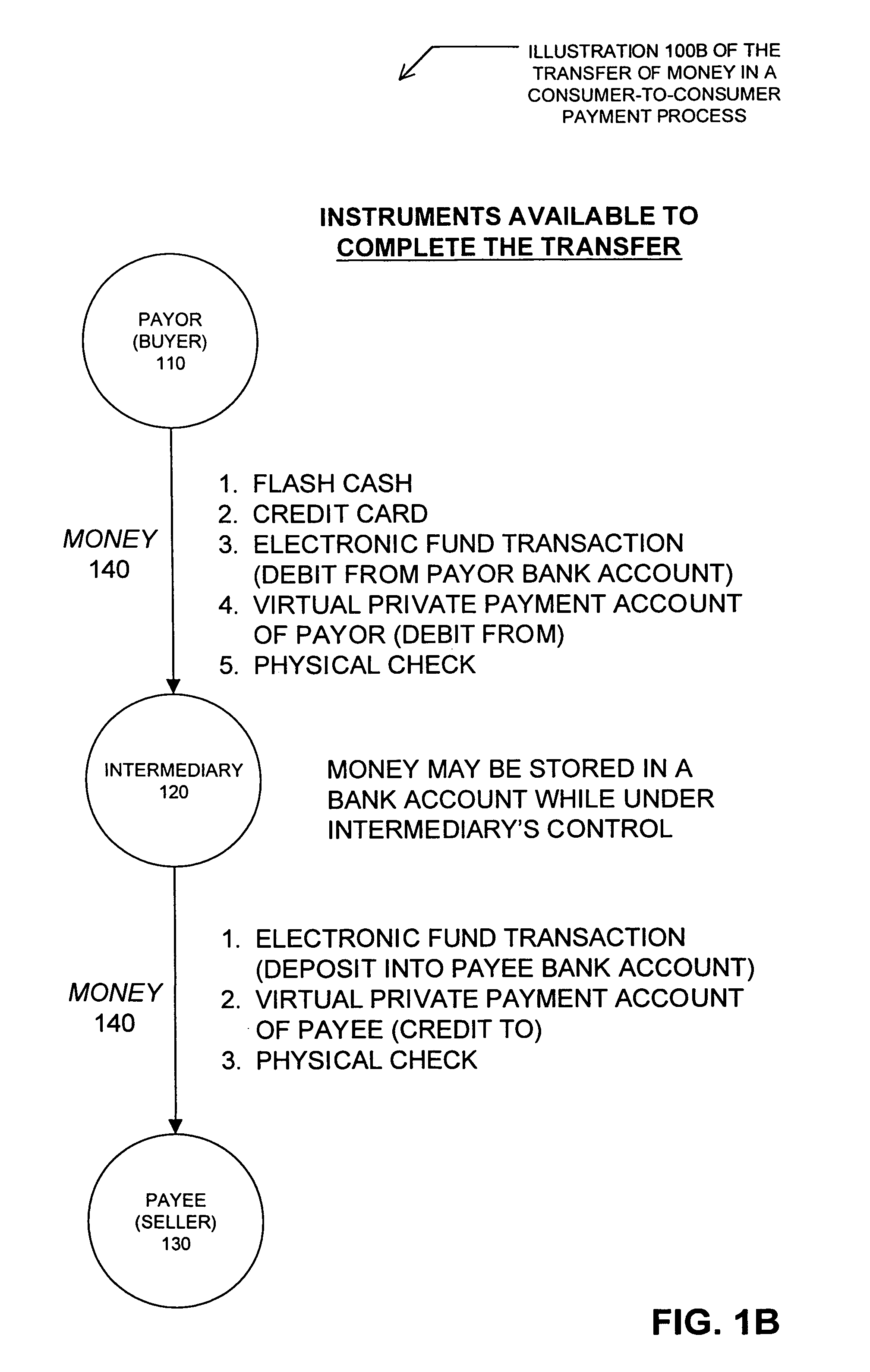

Method and system for facilitating financial transactions between consumers over the internet

InactiveUS7177836B1Reduce the risk of fraudFinanceBuying/selling/leasing transactionsPaymentThird party

A method for enabling two individual consumers to complete a transaction that includes payment from one consumer (the payor, or buyer) to another consumer (the payee, or seller). An intermediary typically operates the service over a computer network of nodes, such as the Internet. The buyer has the convenience of paying through a variety of different payment instruments. Likewise, the seller has the convenience of receiving payment through a variety of different disbursement instruments. For a fee, the intermediary collects the payment from the buyer and pays the seller. Although the intermediary may receive payment from the buyer before the intermediary transfers the payment to the seller, the intermediary may choose to pay the seller before receiving payment from the buyer. In this case, the intermediary assumes the risk of nonpayment by the buyer. Alternatively, the intermediary may pay a third party that specializes in processing transactions for the payment instrument chosen by the buyer to assume the risk of nonpayment by the buyer. In this case, the intermediary receives a promise of payment from the third party before the intermediary pays the seller. Such a promise of payment from the third party is referred to as an authorization.

Owner:THE WESTERN UNION CO +1

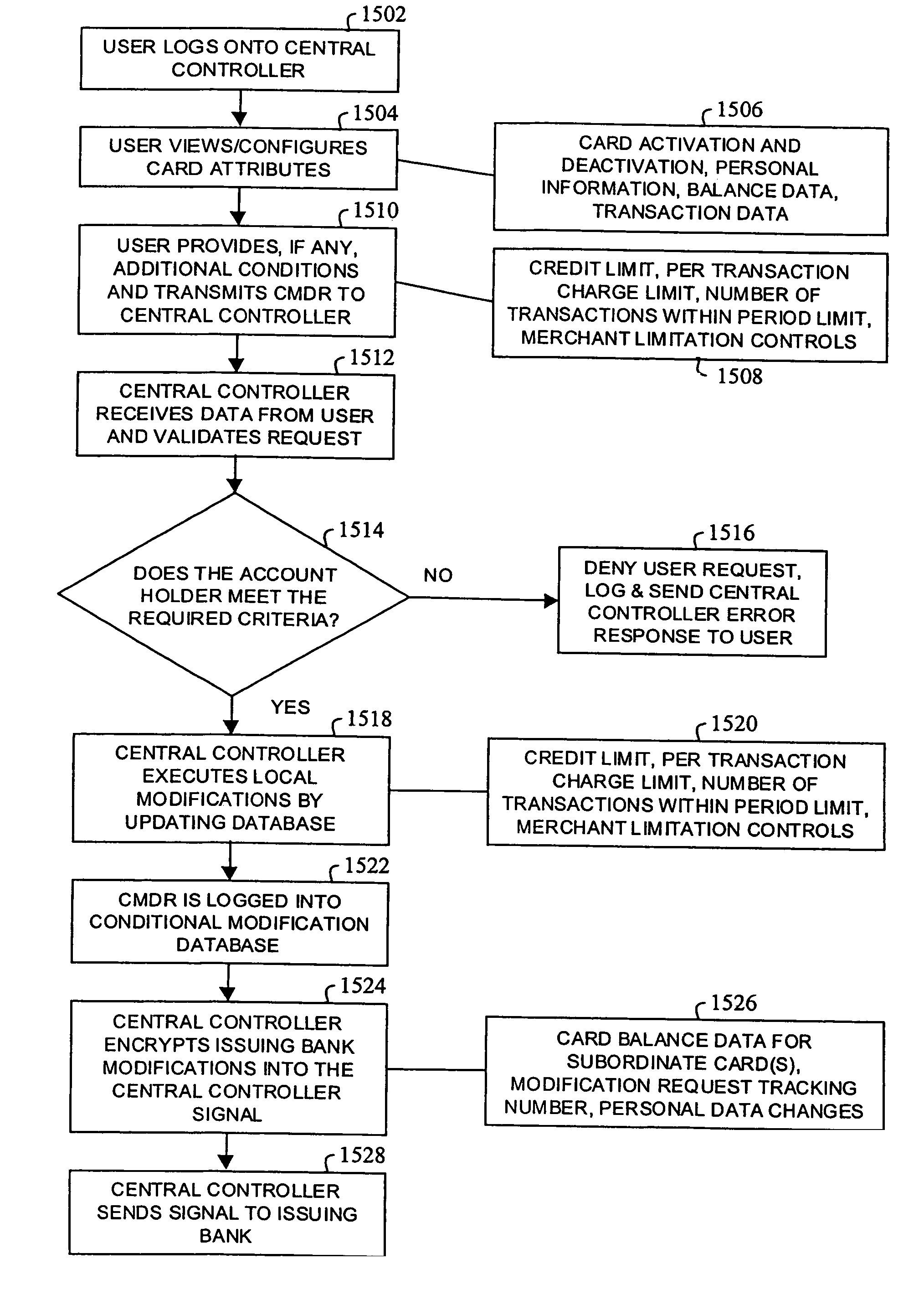

Method, system and computer readable medium for web site account and e-commerce management from a central location

InactiveUS7865414B2Minimizing activation timeMinimizing financial exposureAcutation objectsFinanceWeb sitePayment

A method, system, and computer readable medium for managing a financial transaction of a user at a merchant, including authenticating the user via a device of the user while the user is at the merchant; transmitting activation information for activating a reusable, pre-existing, unaltered and permanent credit or debit card account number of the user from the user device to a financial institution for processing financial transactions, while the user is authenticated; submitting a payment request including the account number to the financial institution from the merchant, while the account number is activated; and de-activating the account number after the payment request is processed by the financial institution. The financial institution only accepts and processes payment requests received from merchants while the account number is activated, and the financial institution declines payment requests while the account number is de-activated.

Owner:SLINGSHOT TECH LLC

Method, system and computer readable medium for web site account and e-commerce management from a central location

A method, system and computer readable medium for managing a user online financial transaction at a destination ecommerce web site using a credit or debit card account of the user, including a) transmitting an activation command to a financial institution processing financial transactions for activating the credit or debit card account of the user; b) submitting a charge request for the credit or debit card account to the financial institution via a destination e-commerce web site to which the user is logged in while the credit or debit card account is in the activated status; and c) transmitting a de-activation command to said financial institution for de-activating the credit or debit card account, wherein the financial institution only accepts and processes charge requests received from e-commerce web sites while the credit or debit card account is in the activated status and wherein the financial institution declines charge requests while said credit or debit card account is in the de-activated status, and wherein steps a) to c) are repeated at least once.

Owner:SLINGSHOT TECH LLC

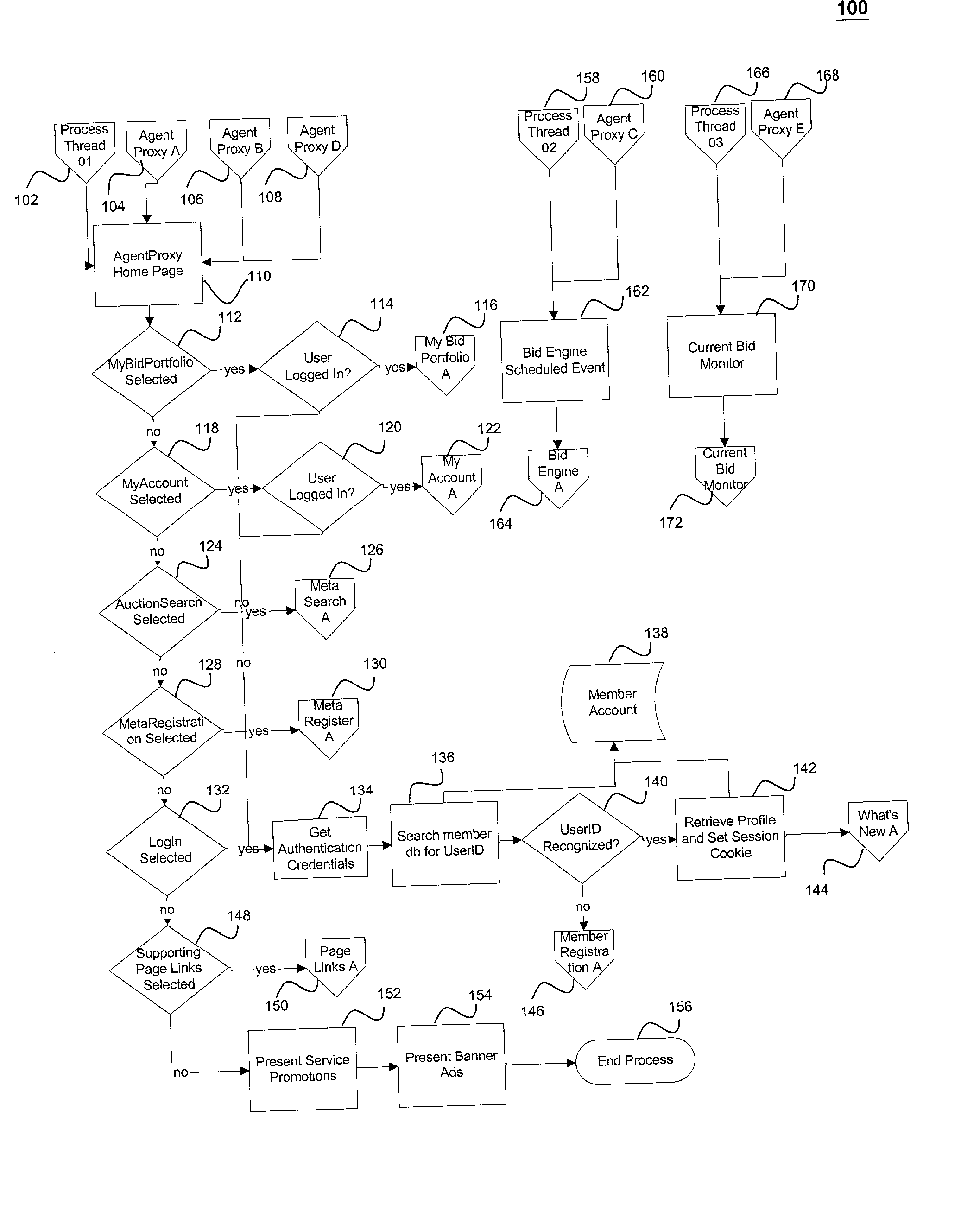

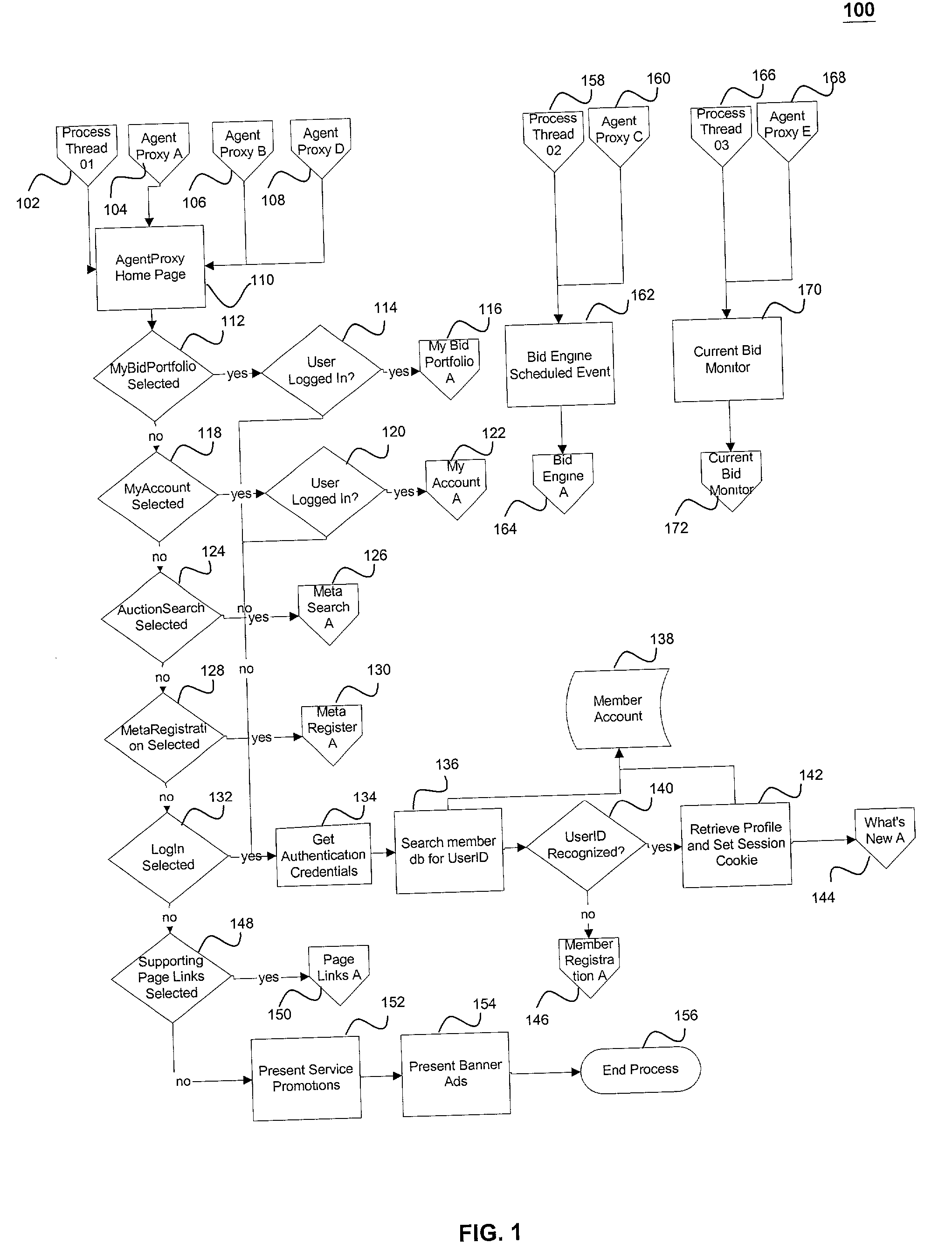

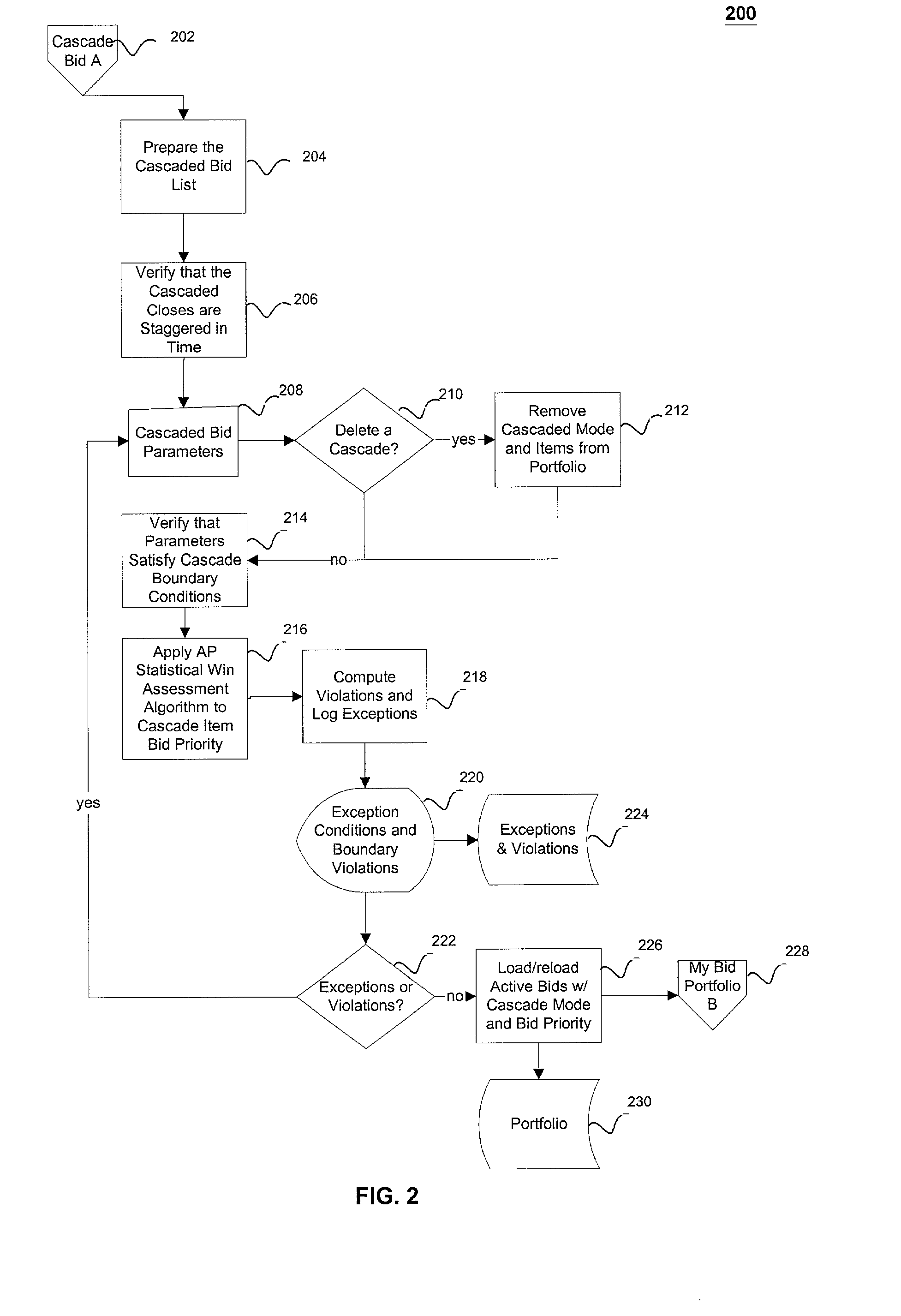

Buyer-side auction dynamic pricing agent, system, method and computer program product

ActiveUS20020038282A1Increase win rateImprove performanceFinanceCommerceMessage passingComputer program

The present invention sets forth a system, method, and computer program product for automating an interaction between a buyer and an electronic, variable, dynamic pricing online auction service. The method can include receiving a registration of a buyer at an Internet enabled buyer bidding site, a portfolio, and account information. The method can also receive entered information about financial transaction instruments, contact information, and product preferences in an auction profile. The method can receive a search query for a desired product from product auctions of a plurality of auction sites and can use a search agent or a meta-search agent, and can provide returned auctions, including retrieving and presenting current status of product auctions. The method can receive a selection of returned auctions to store in the portfolio for tracking by scan agents and for bidding by bid proxies. The method can receive selections of product auctions of the returned auctions and place the product auctions into the portfolio for use by a cascaded bid proxy. The method can provide auction monitoring by scan agents of temporal progression of product auctions, and can notify someone via a messaging center of any changes in relevant aspects of the status that could prevent an initial bid from being placed by a bid proxy. The method can enable activation of bid proxies as an auction nears completion to begin placing bids until the auction is won or lost by auction closing and can confirm a counter-offer has not out-bid. The method can compute and execute another higher bid if a counter-offer has been made and accepted, higher than the most recent bid detected

Owner:LIFEPROXY

System and method for using loyalty rewards as currency

InactiveUS20120035998A1Convenient transactionPayment circuitsMarketingLoyalty programFinancial transaction

The present invention involves spending loyalty points over a computerized network to facilitate a transaction. With this system, a loyalty program participant is able to use an existing transaction card to purchase an item over a computerized network, while at the same time offsetting the cost of that transaction by converting loyalty points to a currency value credit and having the credit applied to the participant's financial transaction account. Currency credit from converted loyalty points may also be applied to stored value cards, online digital wallet accounts and the like. Further, currency credit may also be applied to other accounts to effect a gift or donation.

Owner:LIBERTY PEAK VENTURES LLC

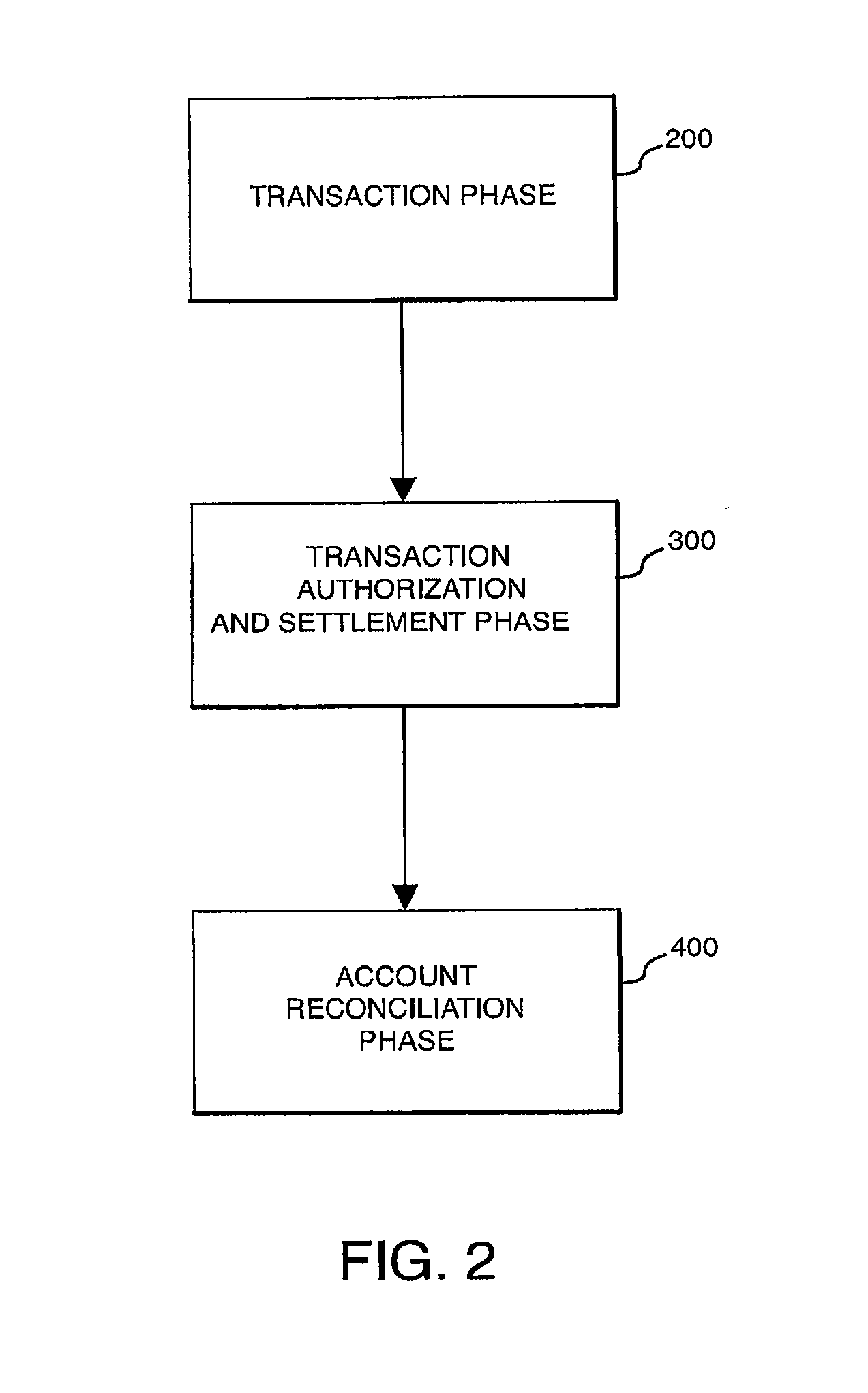

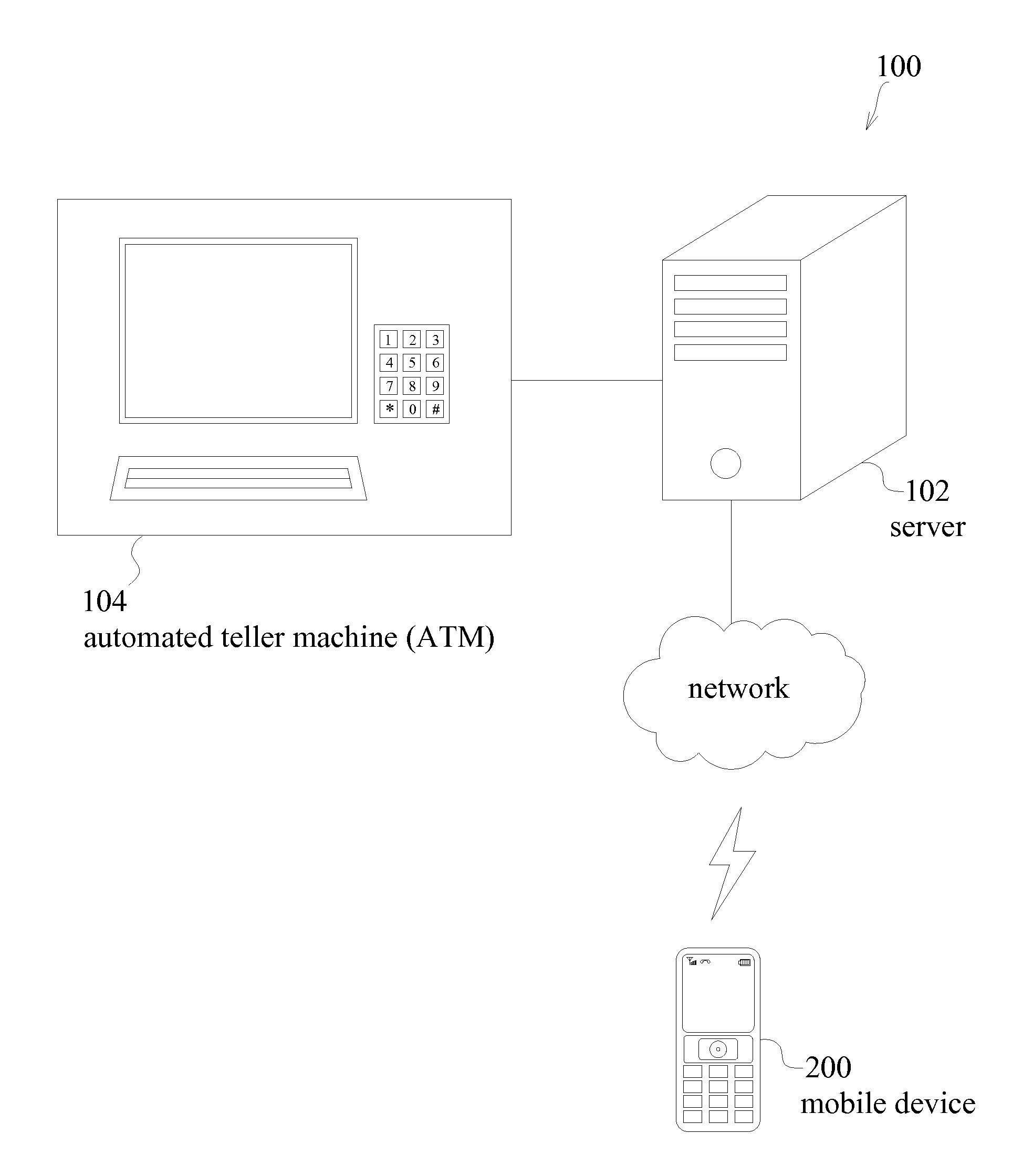

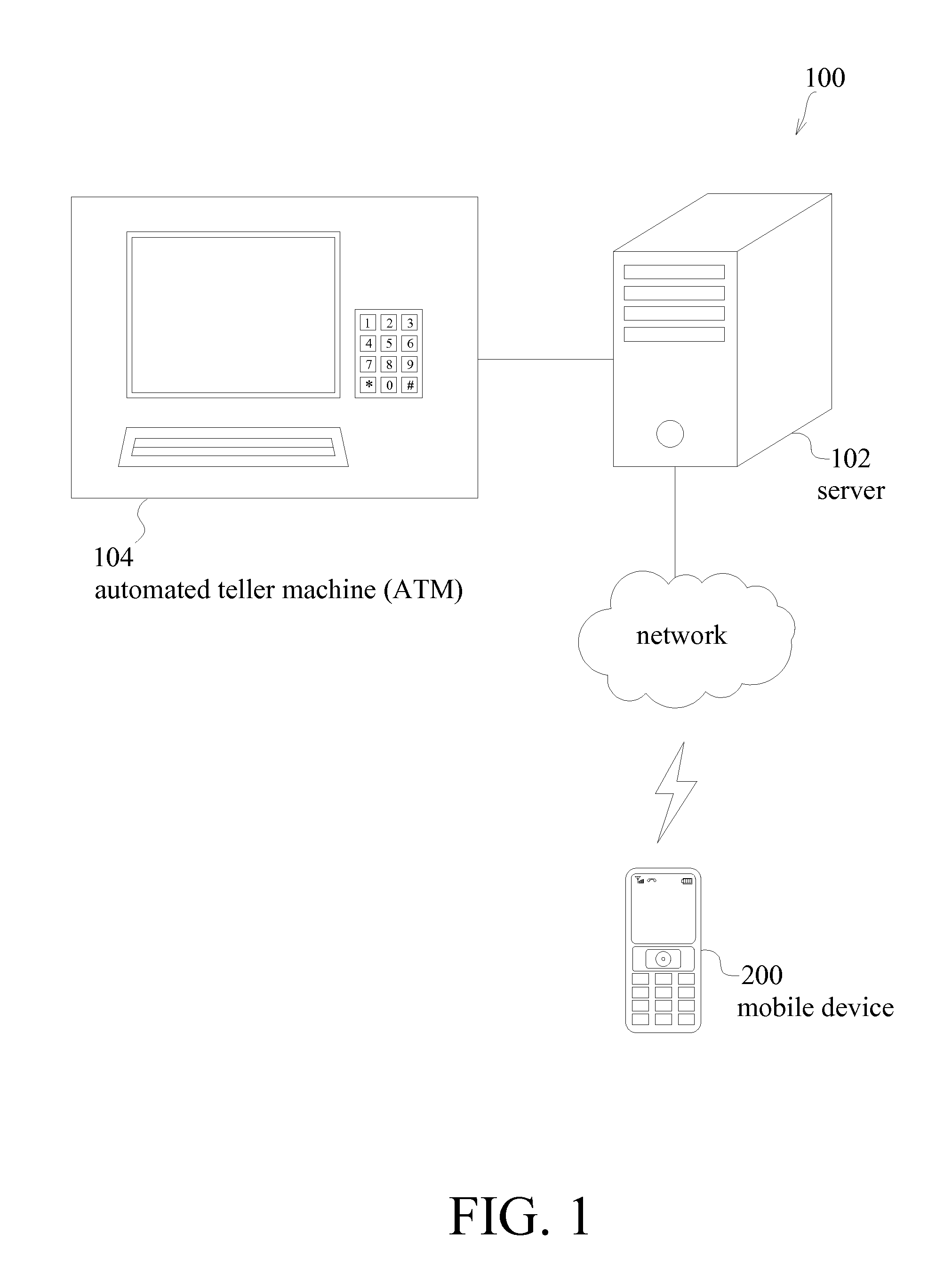

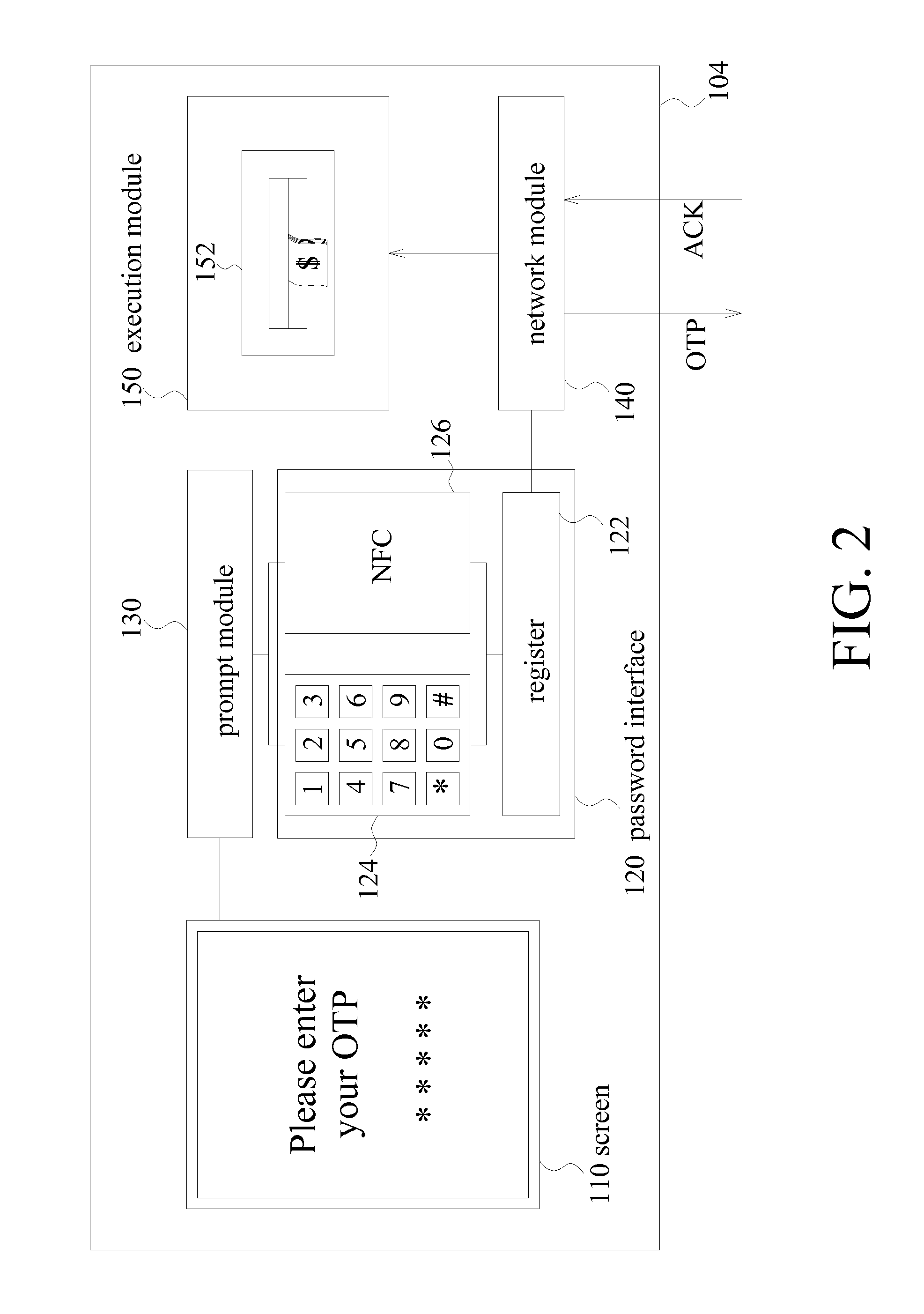

Financial transaction system, automated teller machine (ATM), and method for operating an ATM

InactiveUS20110016047A1Improve transaction securityImprove securityFinanceAutomatic teller machinesFinancial transactionFinancial trading

A financial transaction system is provided. The financial transaction system includes a server and at least one automated teller machine (ATM). In response to a request from a user, the server issues a one-time password (OTP) to the user's mobile device. The ATM receives an OTP from the user and sends the received OTP to the server for verification, in order to perform a financial transaction operation.

Owner:MIXTRAN INC

Mobile system and method for payments and non-financial transactions

InactiveUS8635157B2Readily availableLow costFinanceBuying/selling/leasing transactionsVirtual terminalPayment transaction

A method and system for mobile commerce, communication, and transaction processing to real-world POS, web, e-commerce, virtual terminal, mobile personal digital assistant, mobile phone, mobile device, or other computer based transactions involving either one or both financial and non-financial such as loyalty based transactions as a mobile payment system is described. One embodiment comprises using a mobile phone via a consumer mobile software application (CMA) in lieu of a consumer card (examples include physical, virtual, or chips) to conduct payment transactions in the Real or Virtual World of commerce. An embodiment is related to making payments to real-world stores via having the CMA on a mobile device on behalf of the consumer present to conduct transactions and no physical card required.

Owner:PAYME

Method, transaction card or identification system for transaction network comprising proprietary card network, eft, ach, or atm, and global account for end user automatic or manual presetting or adjustment of multiple account balance payoff, billing cycles, budget control and overdraft or fraud protection for at least one transaction debit using at least two related financial accounts to maximize both end user control and global account issuer fees from end users and merchants, including account, transaction and interchange fees

InactiveUS20070168265A1Increase flexibilityEasy maintenanceComplete banking machinesFinanceCredit cardFinancial transaction

The present invention provides methods, systems and transaction cards or identification systems, using transaction network comprising proprietary card network, EFT, ACH, or ATM, for end user management of a global financial account by manual or automatic prepaying, prepaying, paying or unpaying, debiting or crediting, or readjustment or presetting, using parameters relating to portions of paid or unpaid financial transactions or account balance amounts in multiple credit, cash or other existing, or end user created, financial accounts or sub-accounts in said global financial account that is optionally subject to financial account issuer transaction or readjustment fees from end users and merchants, including optional use for financial transactions as a credit transaction card requiring merchant credit card interchange or other fees, and optional end user fees, as additional revenue to the global account issuer.

Owner:ROSENBERGER RONALD JOHN

Mobile Device Based Financial Transaction System

A system and method for conducting financial transactions by means of a smartphone is disclosed. A barcode is printed on the invoice, which is scanned by the mobile device screen. The mobile device is used instead of a credit card or cash. Provisions for data security, transaction verification, and communications protocols are disclosed.

Owner:SINCAI DAN MOSHE

Dynamic primary account number (PAN) and unique key per card

Methods, systems, and machine-readable media are disclosed for handling information related to a financial transaction including utilizing dynamic cryptograms. According to one embodiment, a method of processing a financial transaction related to a financial account can comprise detecting initiation of the transaction with a device used as a presentation instrument in the transaction. A Dynamic Transaction Cryptogram (DTC) and a dynamic PAN can be generated at the device. The DTC can be used to authenticate the transaction and the dynamic PAN can comprise an encrypted form of a real PAN of the financial account that is valid for a single transaction. The DTC and the dynamic PAN can be provided by the device for use in the transaction.

Owner:FIRST DATA

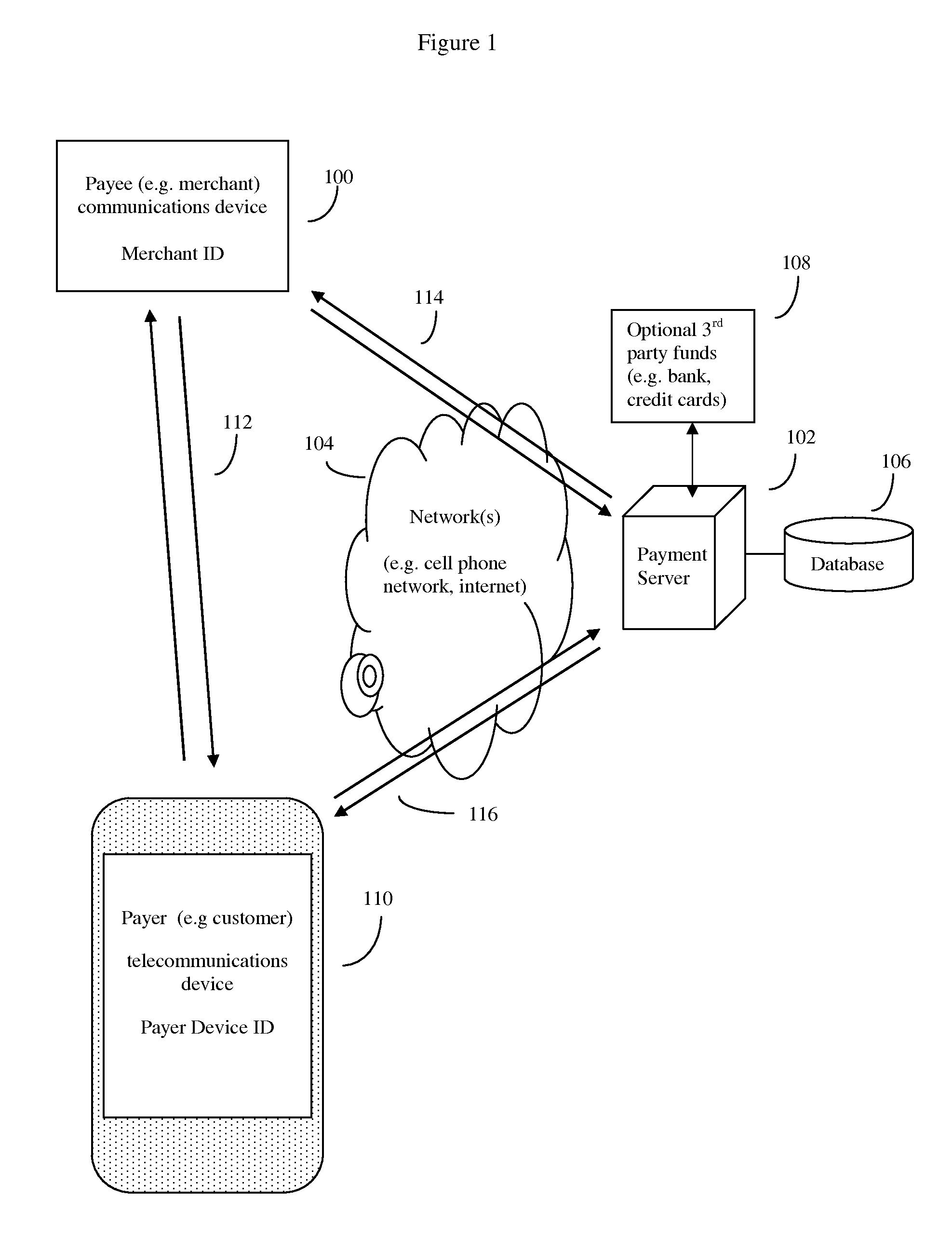

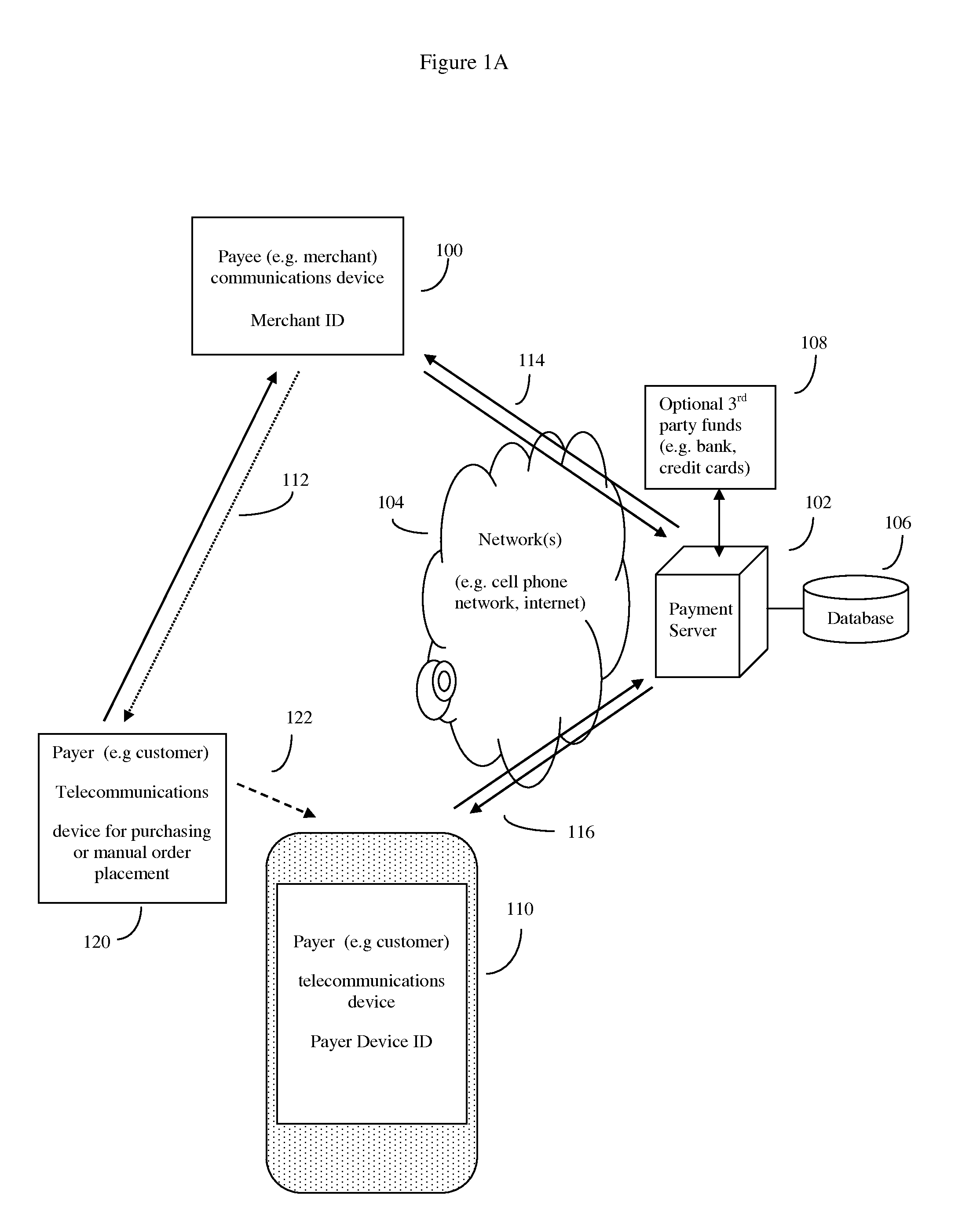

System and method of electronic payment using payee provided transaction identification codes

InactiveUS20130124364A1High degreeImprove conveniencePayment architectureBuying/selling/leasing transactionsPaymentFinancial transaction

A computerized method of payment based on short, temporary, transaction ID numbers which protect the security of the payer's (customer's) financial accounts. The payee will first register a source of funds and a payer device with a unique ID (such as a mobile phone and phone number) with the invention's payment server. Then once a payee (merchant) and the payer have agreed on a financial transaction amount, the payee requests a transaction ID from the payment server for that amount. The payment server sends the payee a transaction ID, which the payee then communicates to the payer. The payer in turn relays this transaction ID to the server, which validates the transaction using the payer device. The server then releases funds to the payee. The server can preserve all records for auditing purposes, but security is enhanced because the merchant never gets direct access to the customer's financial account information.

Owner:MITTAL MILLIND

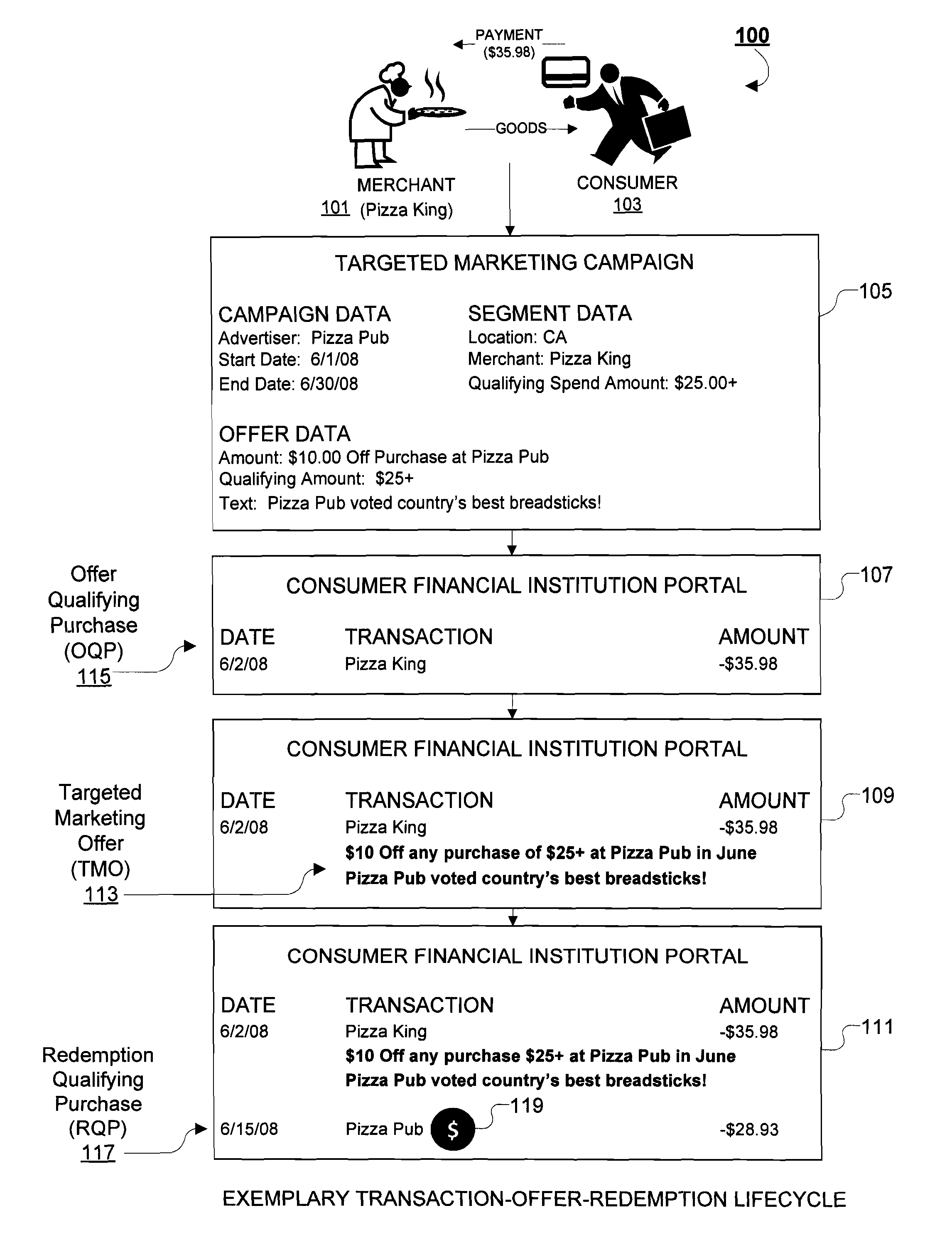

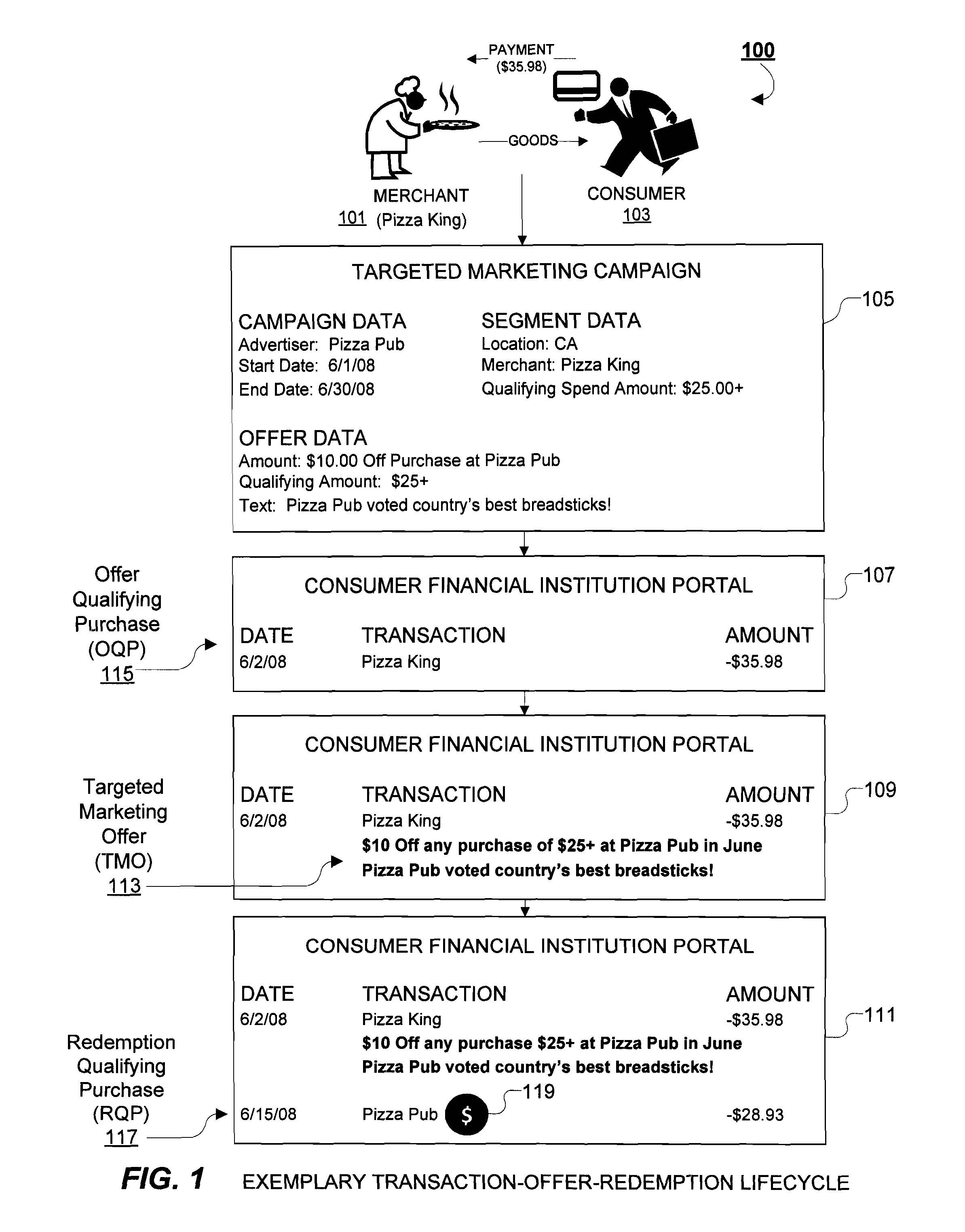

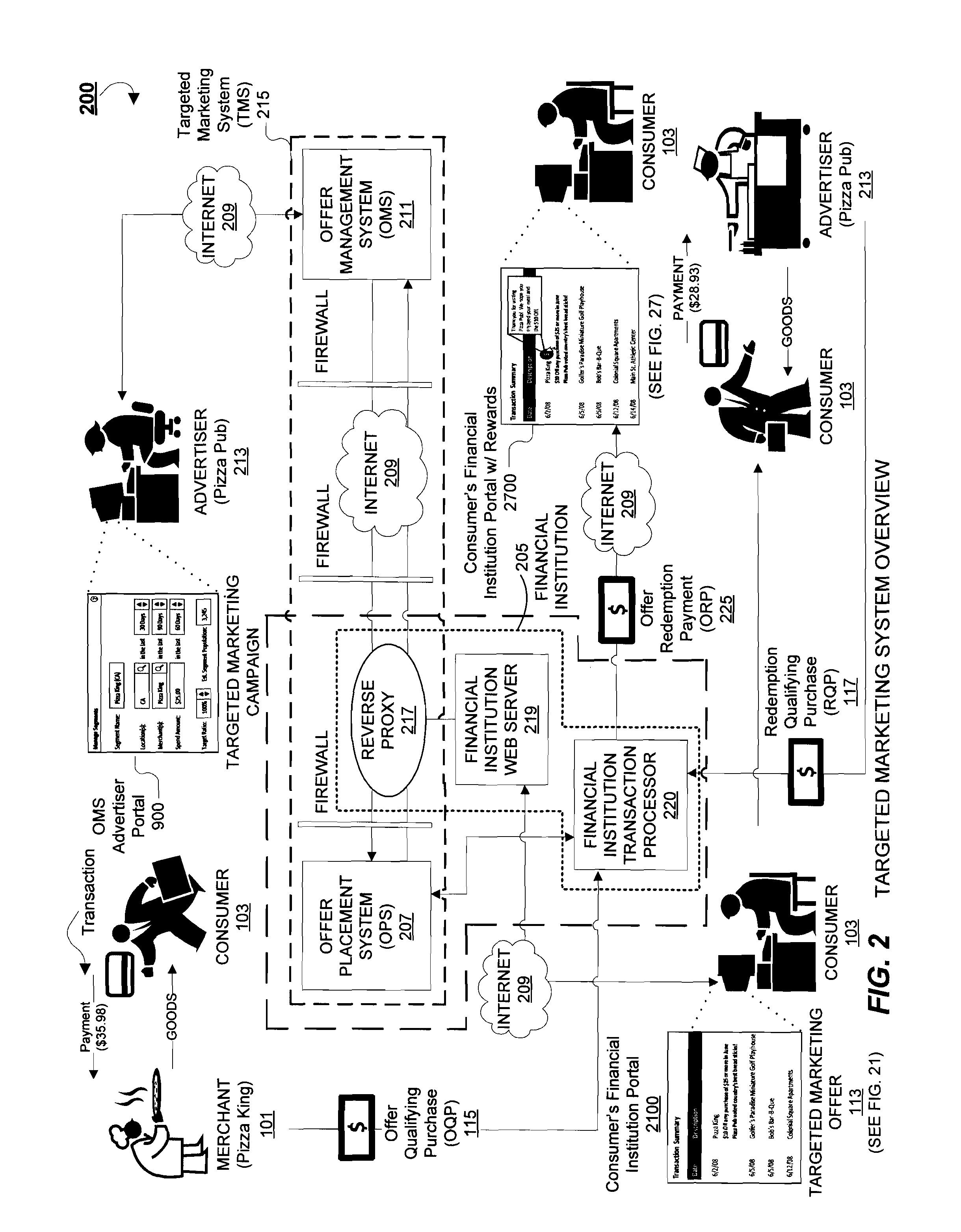

Offer Management System and Methods for Targeted Marketing Offer Delivery System

A system and methods for an offer management system for use in delivering targeted marketing offers to consumers during a session with an online (web-based) Internet portal, such as an online banking portal of a financial institution. A component receives aggregated transaction data from a financial transaction system for use in creation of an advertising campaign. A component provides a marketing campaign interface that allows advertisers to define an advertising campaign by display of information derived from the aggregated transaction data indicating potential market segments defined by the advertiser, define a predetermined market segment, and define a predetermined targeted marketing offer for delivery to consumers under predetermined conditions. A component outputs the campaign data to the financial institution for delivery of the targeted marketing offer to consumers within the predetermined market segment in response to the predetermined conditions during online sessions with the portal.

Owner:CARDLYTICS

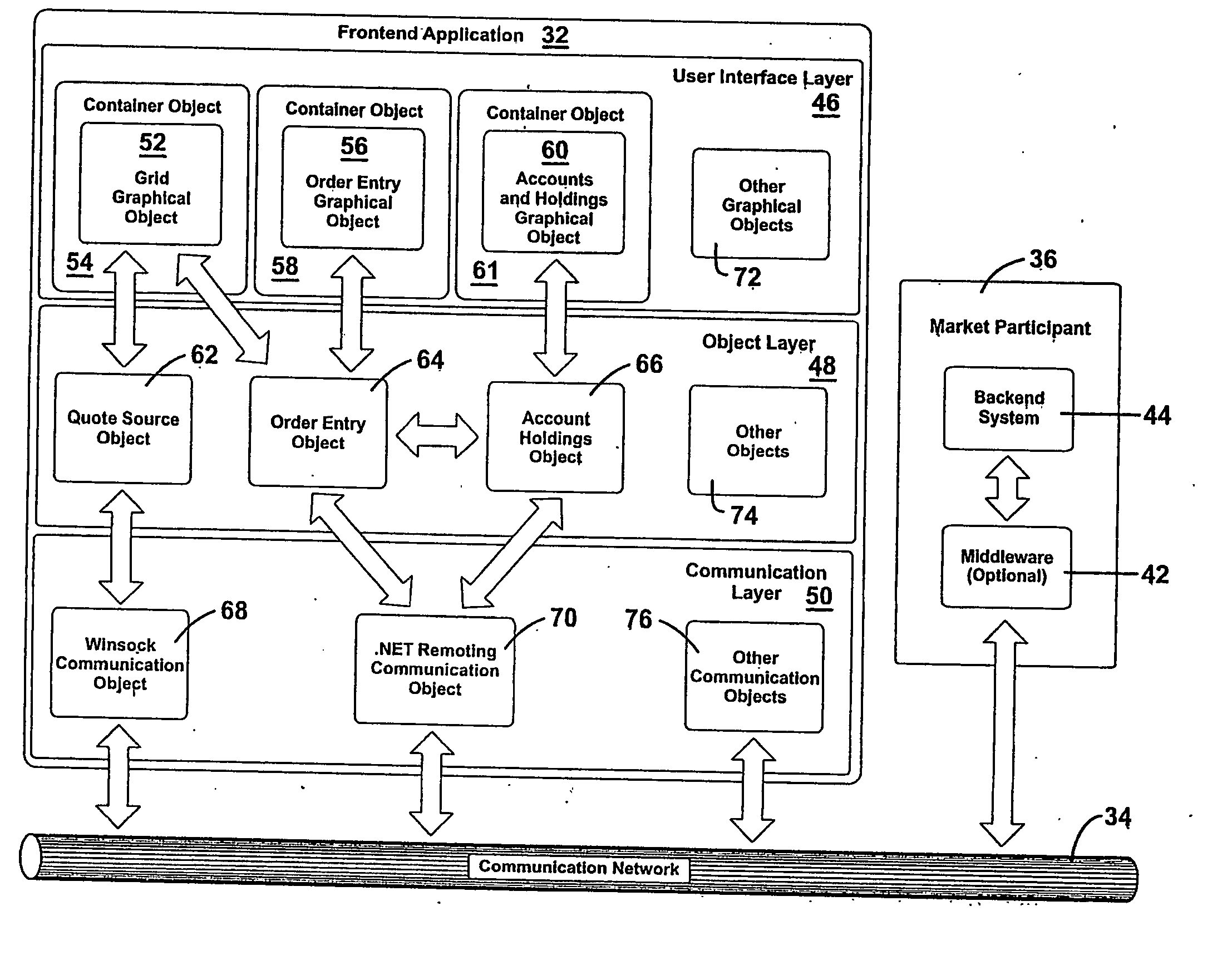

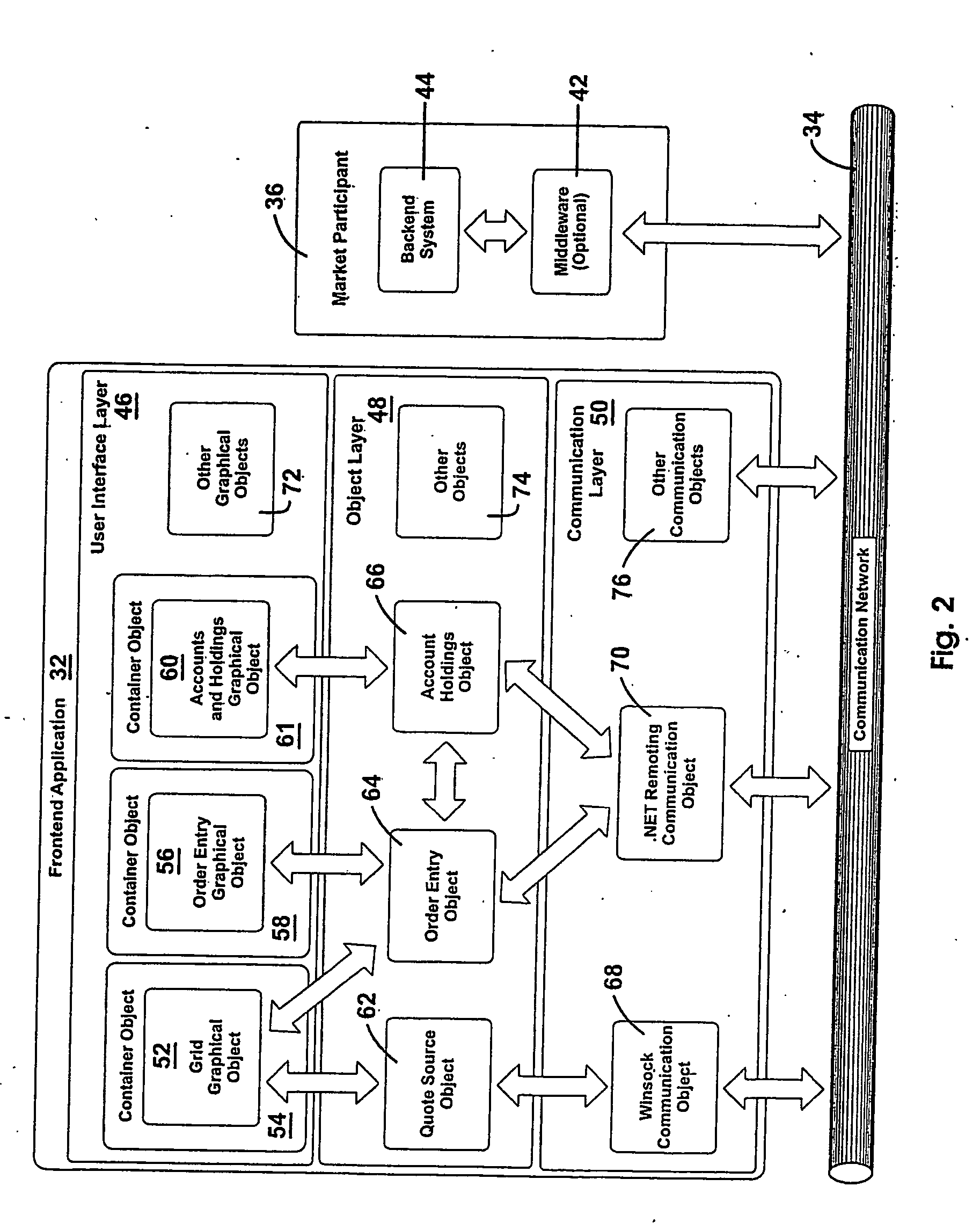

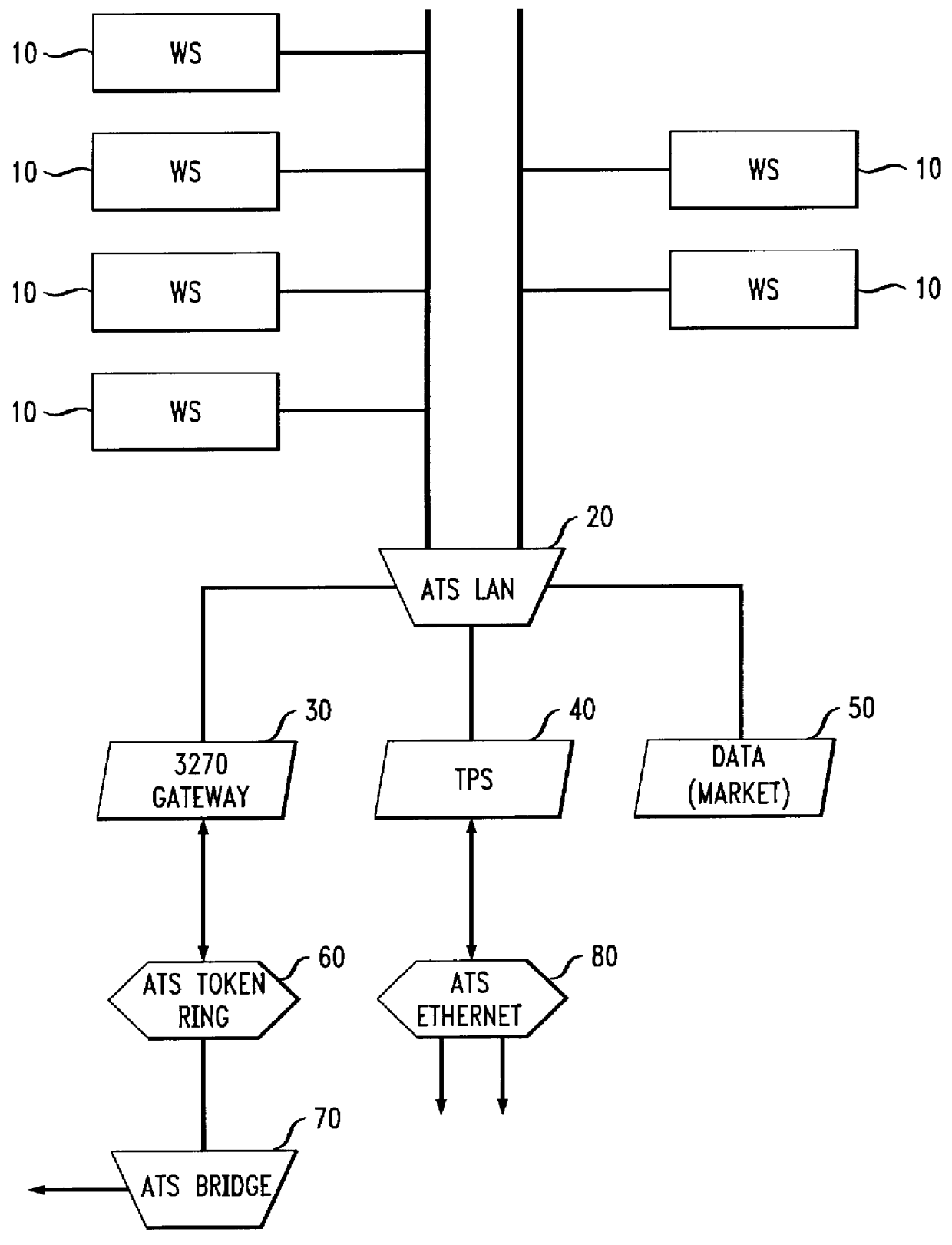

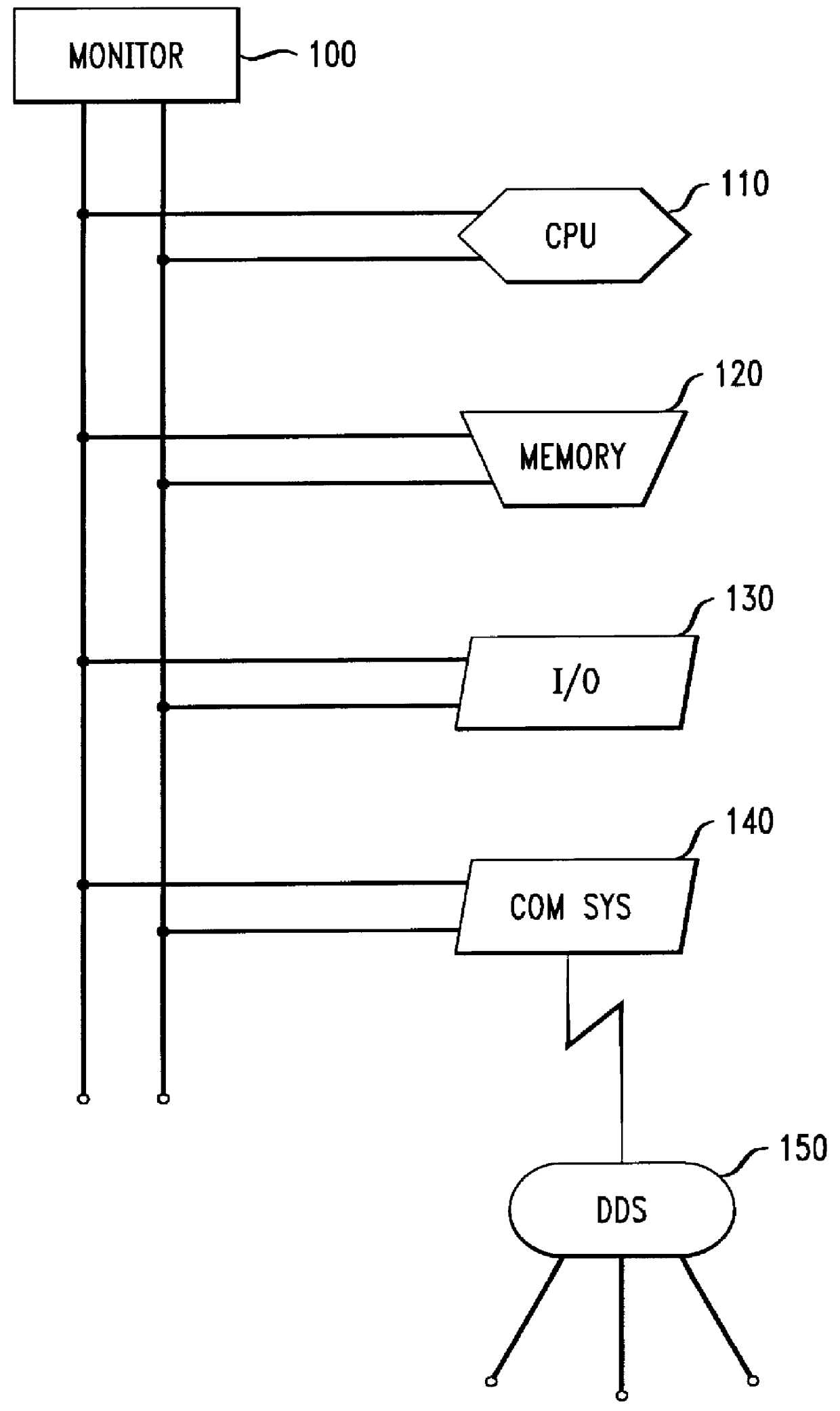

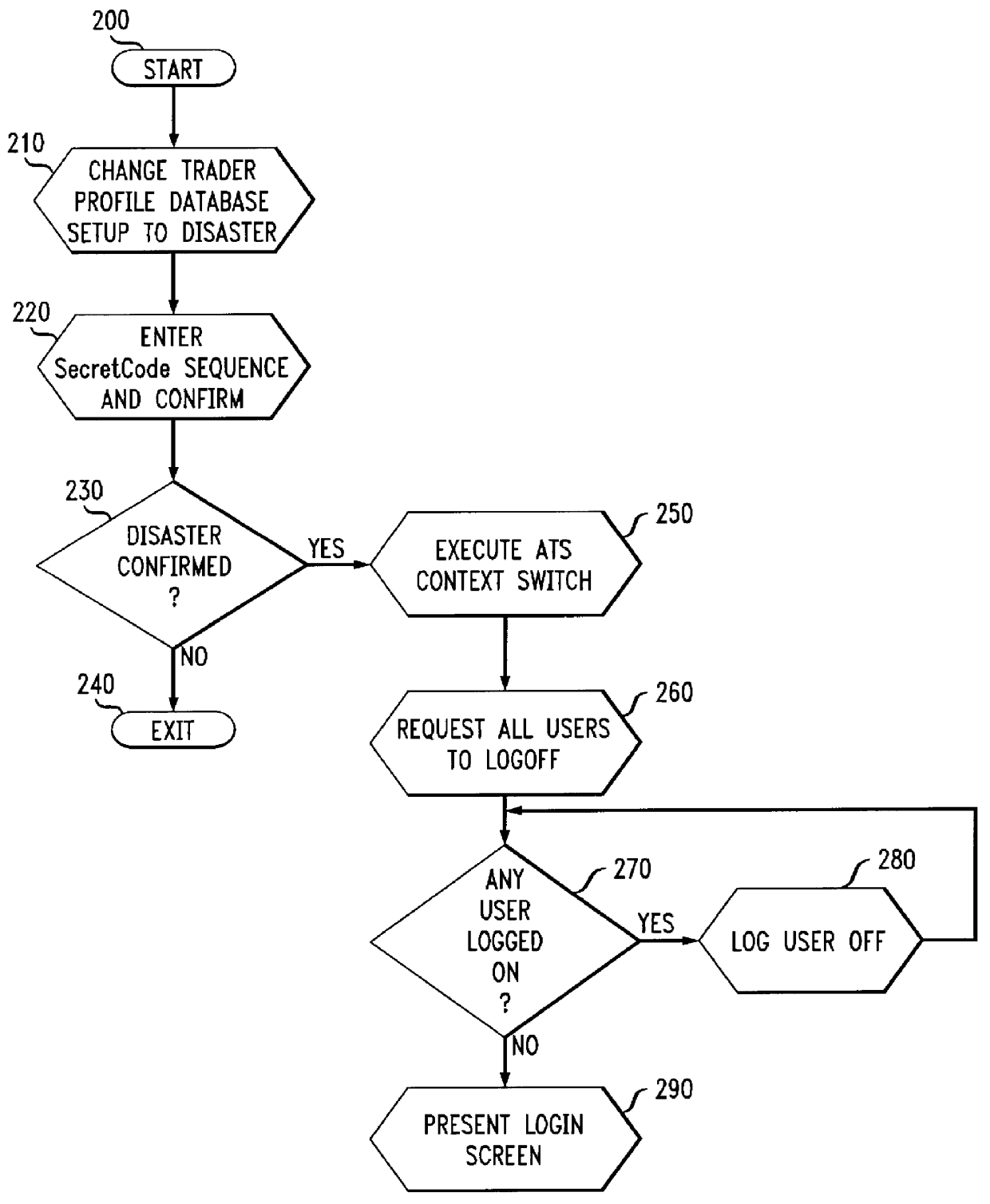

System for enhanced financial trading support

InactiveUS6105005APreventing improper and illegal tradingDiluting the capital commitmentFinanceDigital computer detailsData processing systemOperation mode

A multi-purpose data processing system that is capable of going on-line to provide an operative link with established financial markets in support of subscriber trading. The system has two modes of operation. A first mode is directed to support for financial transactions or services that are necessary, but not critical. The second mode addresses a lost trading link from a primary trading system pursuant to a catastrophic event, and provides a remote trading platform to a plurality of pre-select traders. The second mode is accessible via disaster declaration, and the system permits custom terminal configuration in accordance with designated traders. Operation allows quick assess to markets when the primary market link outlet is down.

Owner:BANK OF AMERICA CORP

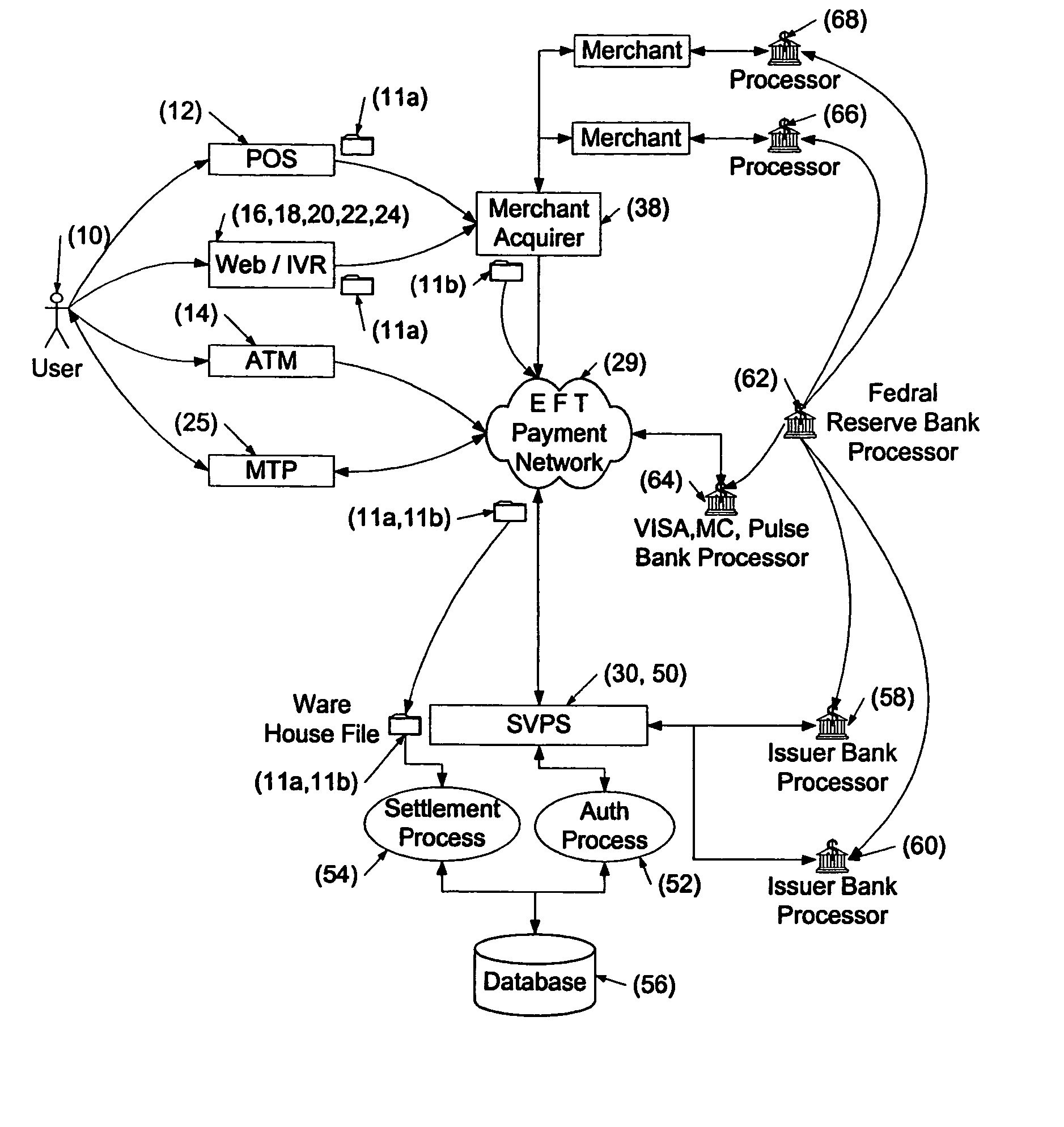

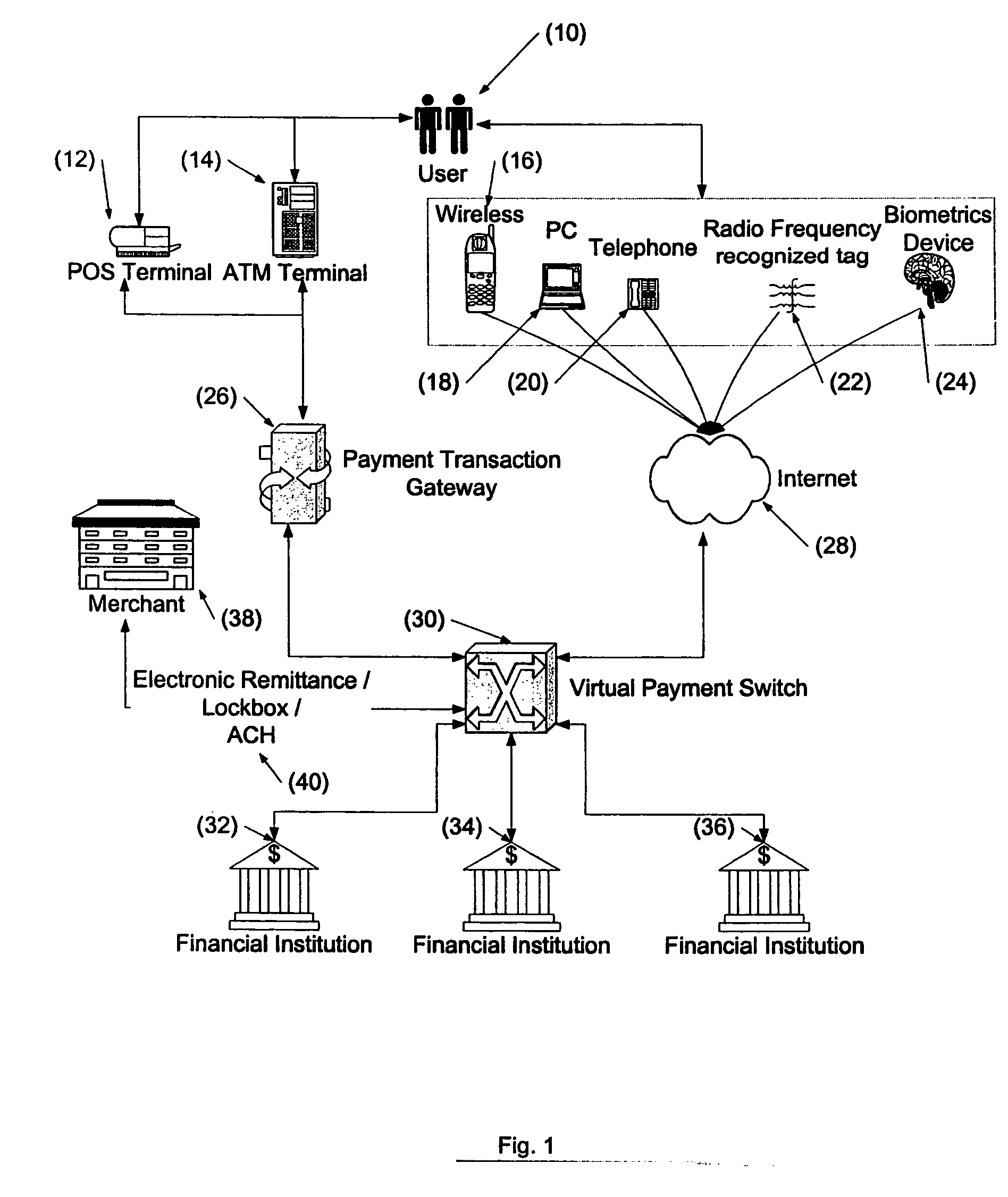

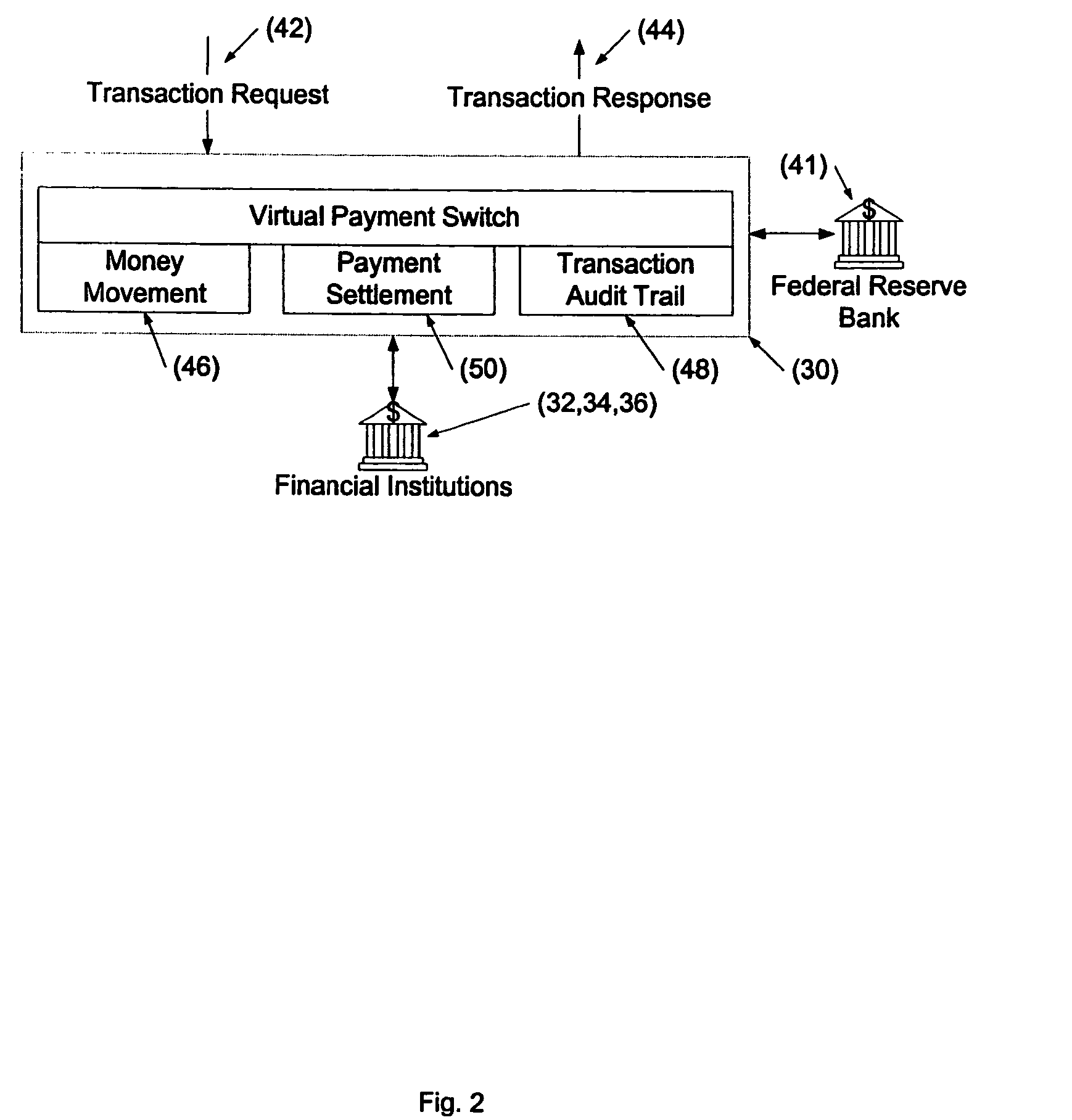

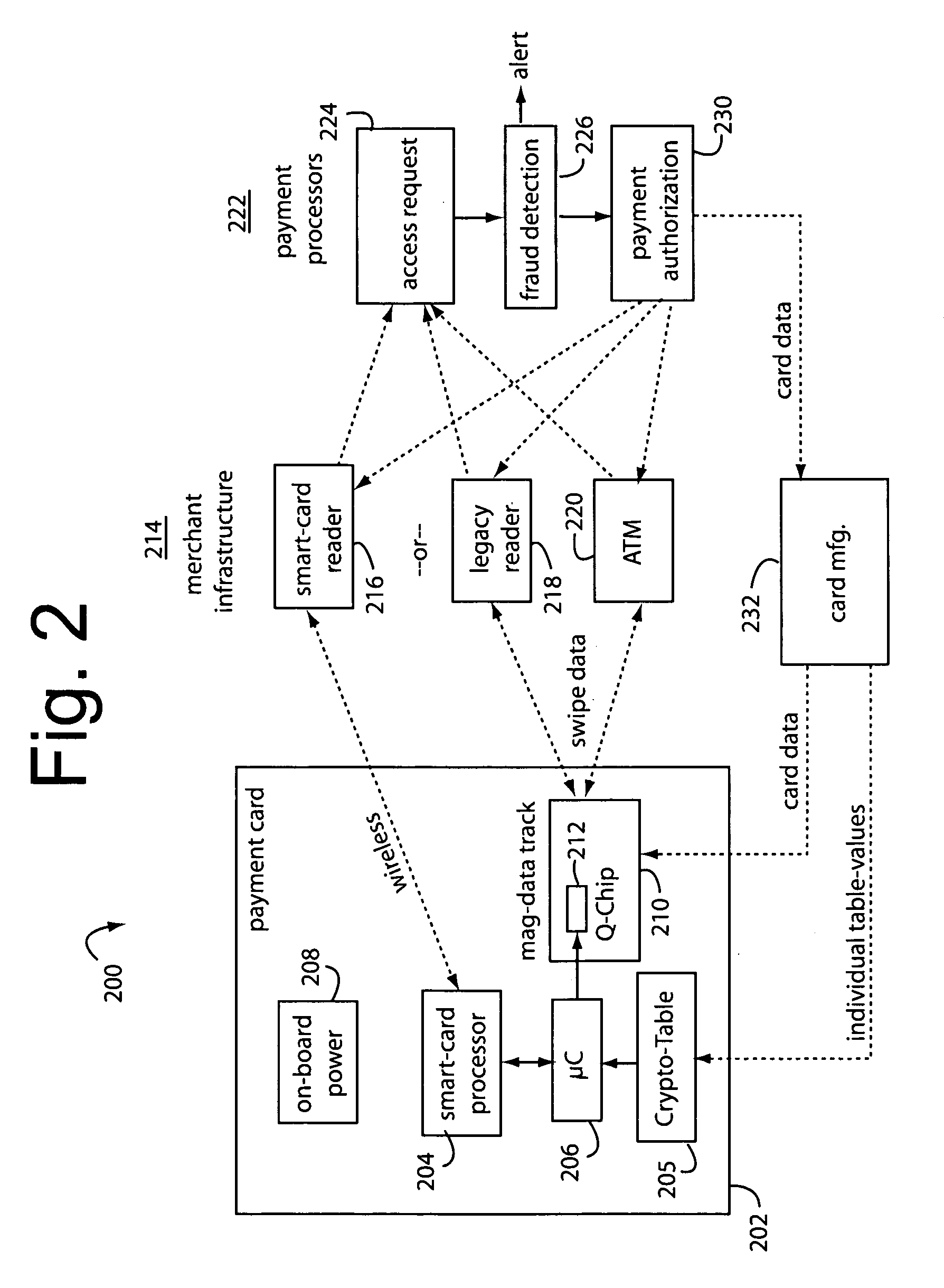

Cashless payment system

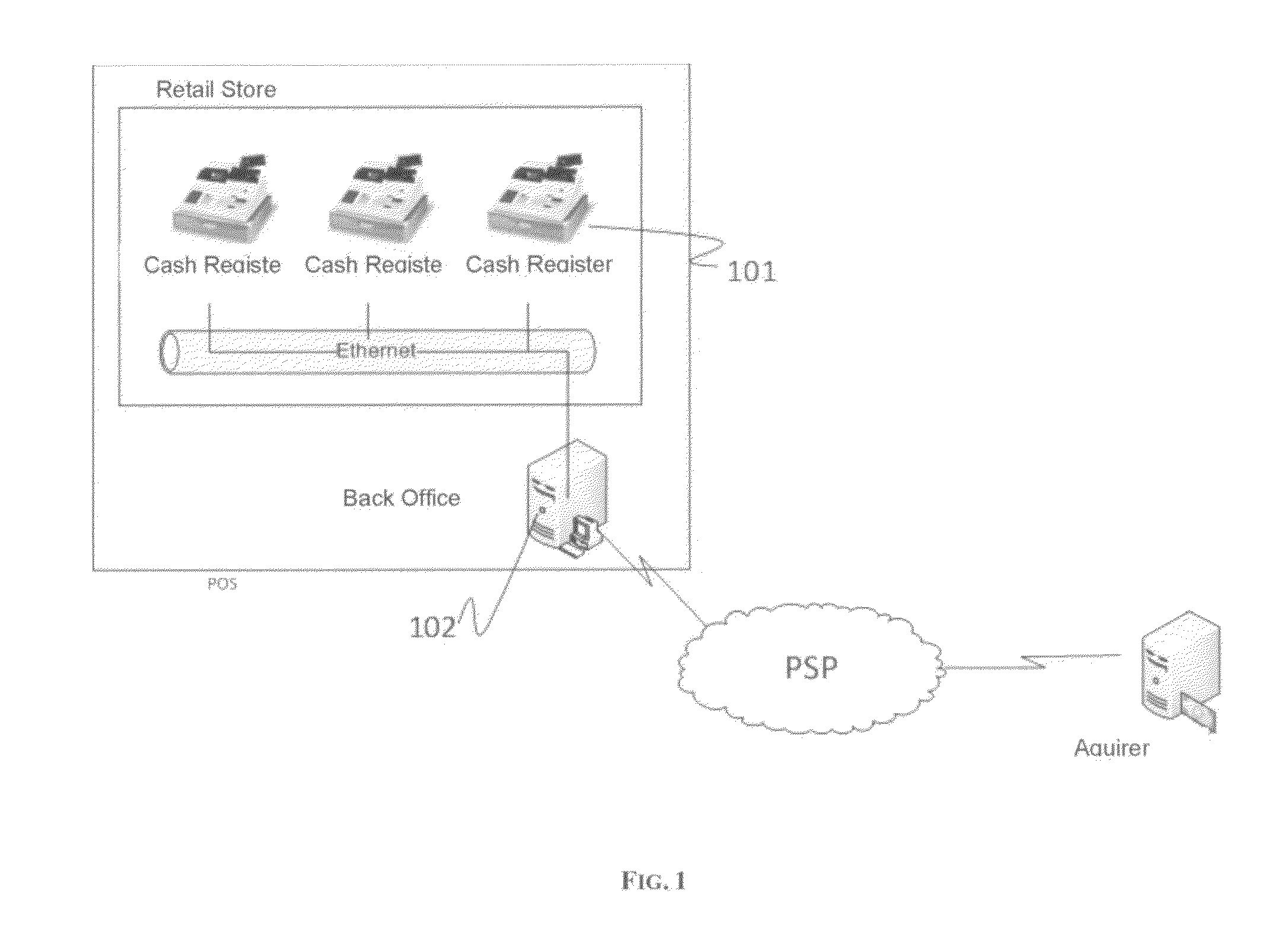

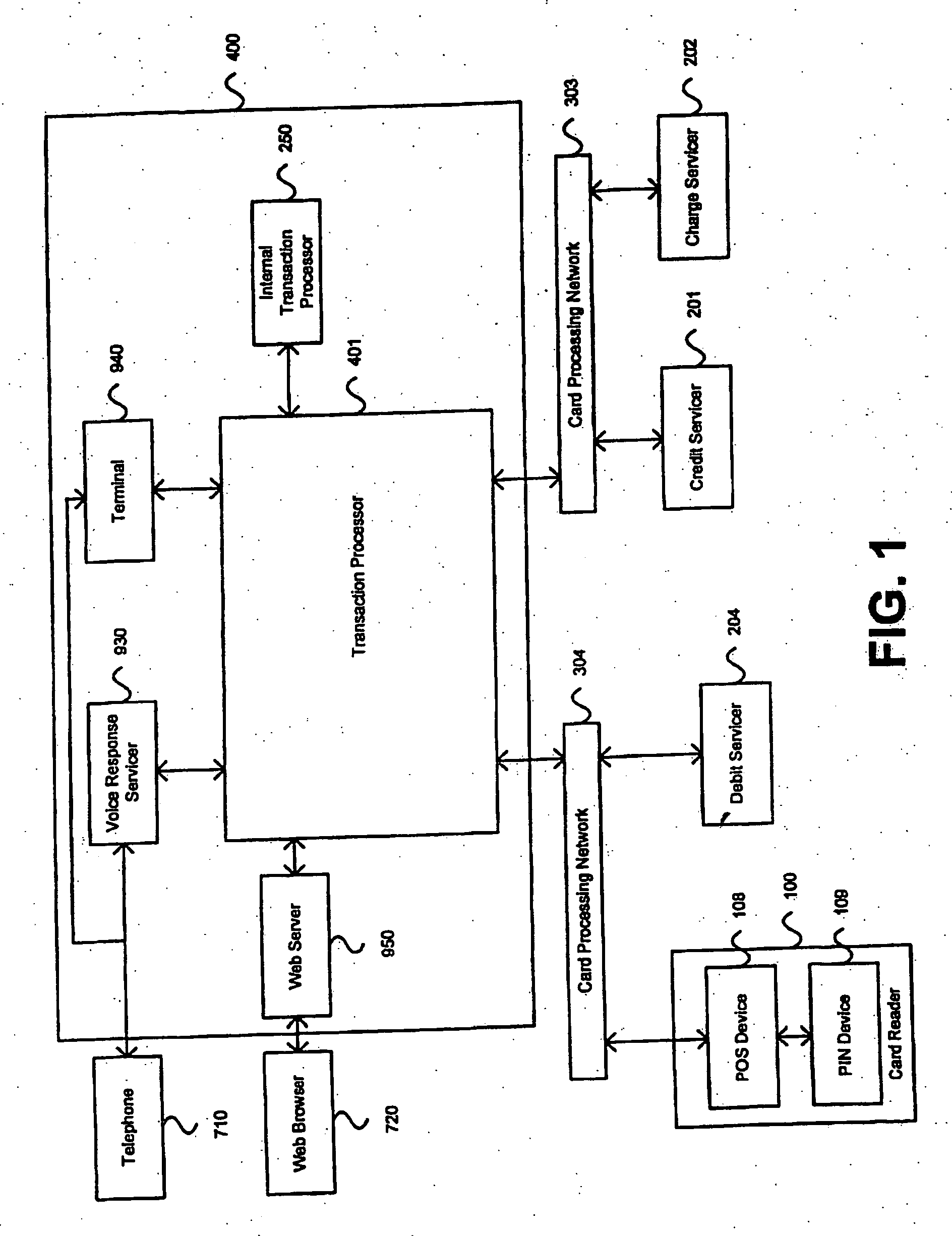

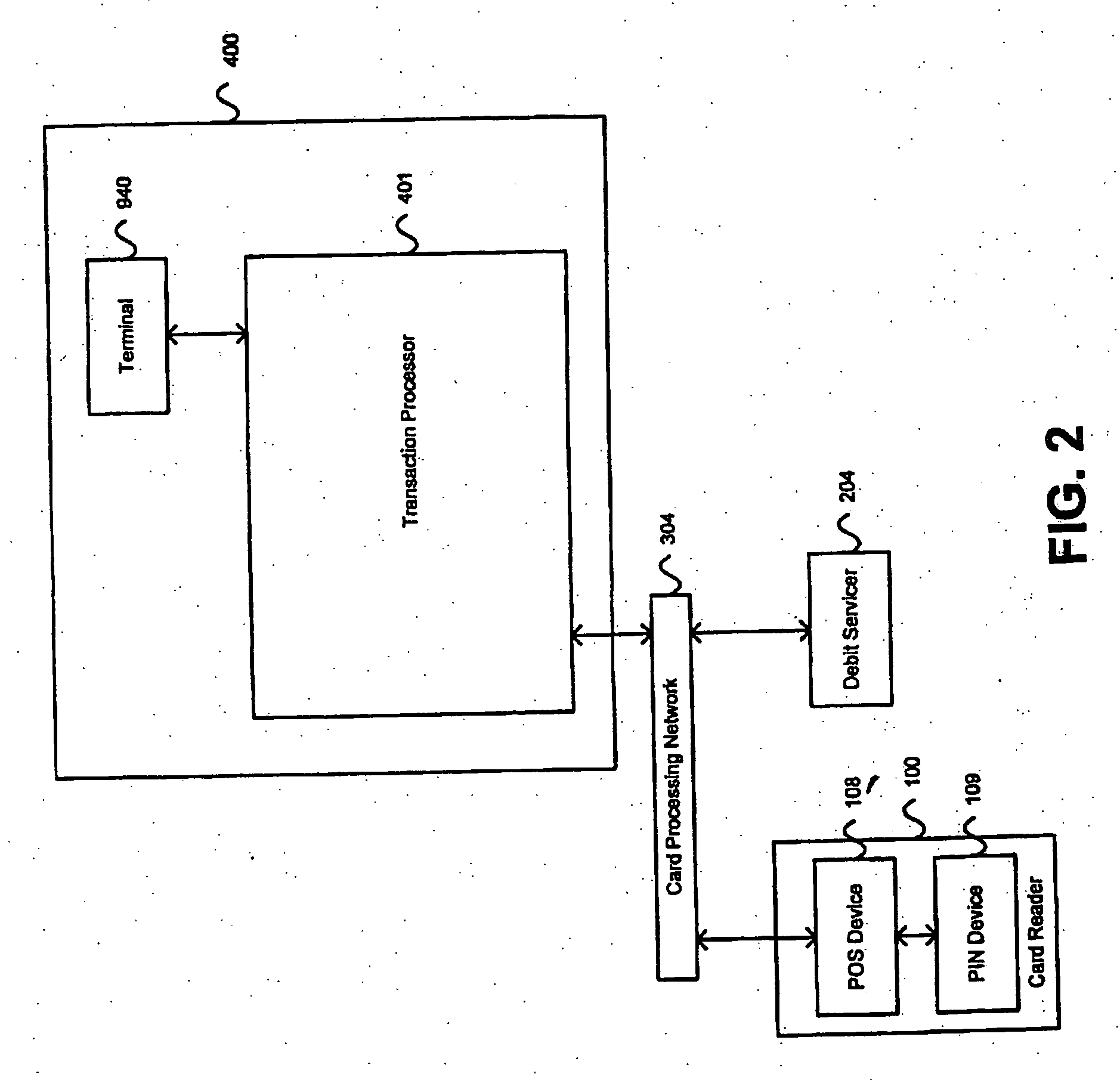

InactiveUS20050015332A1Without any loss of transaction processing flexibilityWidespread acceptanceFinanceBuying/selling/leasing transactionsComputer networkEngineering

A payment system that does not rely on credit or debit cards, does not require the merchant and purchaser to have compatible memberships to complete a transaction, and does not limit single transactions to a single account provides a wide range of flexibility permitting debit, credit, pre-paid and payroll cards to be accommodated in a seamless and invisible manner to the electronic transaction network. The transaction may be verified and approved at the point-of-sale whether or not the merchant is a member of a specific financial transaction system. Specifically, the point-of-sale transaction system permits an identified customer to use any of a variety of payment options to complete the transaction without requiring the merchant to pre-approve the type of payment selected by the customer. In one configuration, and in order to take advantage of the widespread use of the ATM / POS network, the invention uses a typical credit / debit card format to provide the identifying information in a stored value card. When a transaction is to be completed, the user enters the identifying information carried on the card at the point-of-sale. This can be a merchant or other service provider at a retail establishment, or on-line while the user is logged onto a web site, or other location. The information can be swiped by a card reader, or manually entered via a keyboard or other input device. The system supports a wide range of flexibility, permitting issuing systems such as parents and state welfare agencies to restrict the types of authorized uses, and permitting users to access accounts in a prioritized manner. Further, the accepting merchant is not required to be a member because settlement with the merchant may be made via the Federal Reserve Automatic Clearing House (ACH) system by typical and standard electronic transfer. This permits the merchant to take advantage of the lower ACH transaction fees with even greater convenience and flexibility than the current ATM / POS system. The system supports numerous types of identification methods from typical credit card structures with magnetic data strips to various biometric systems such as finger prints, facial recognition and the like. Specifically, once the user is identified, the transaction is managed by his membership data on record with the transaction processing system.

Owner:ECOMMLINK

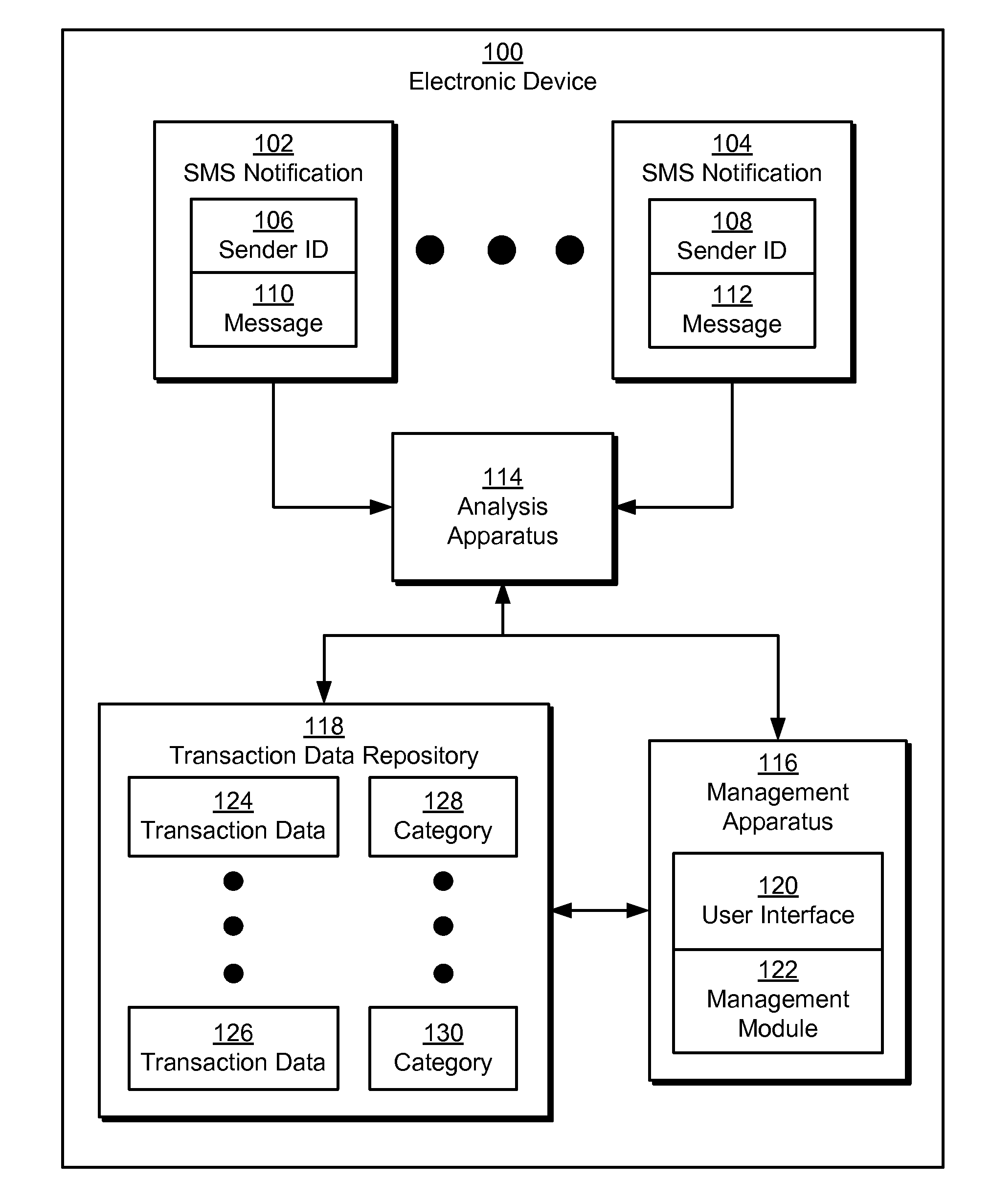

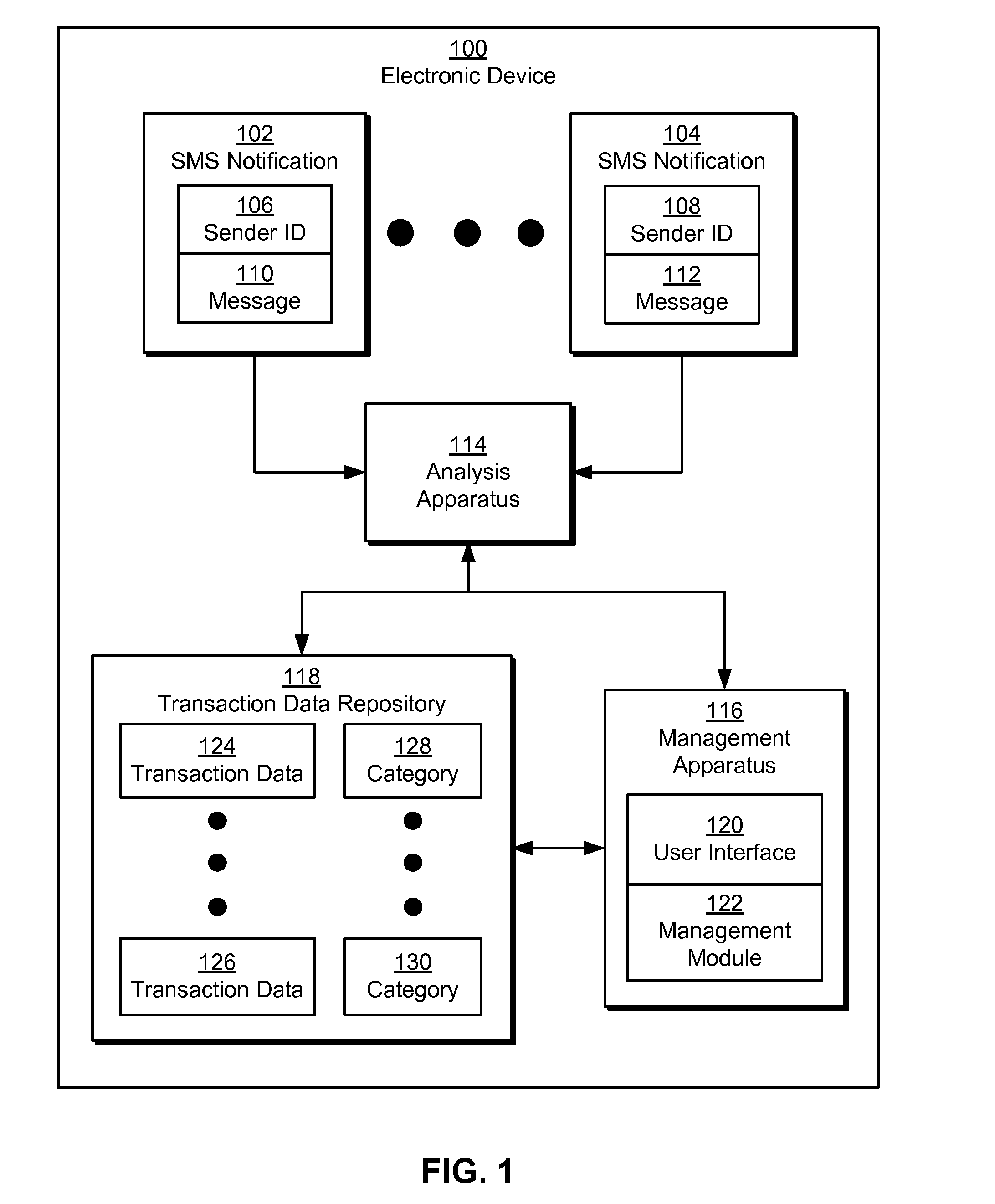

Managing financial transactions using transaction data from SMS notifications

InactiveUS20130290169A1Easy to manageFinancePayment architectureShort Message ServiceTransaction data

The disclosed embodiments provide a system that facilitates management of a financial transaction. During operation, the system obtains transaction data for the financial transaction between a user and an organization from a Short Message Service (SMS) notification on an electronic device of the user. Next, the system determines a category of the financial transaction based on the transaction data. The system also displays the transaction data and the category on the electronic device. Finally, the system uses the displayed transaction data and the displayed category to enable, for the user, management of the financial transaction without accessing the transaction data at the organization.

Owner:INTUIT INC

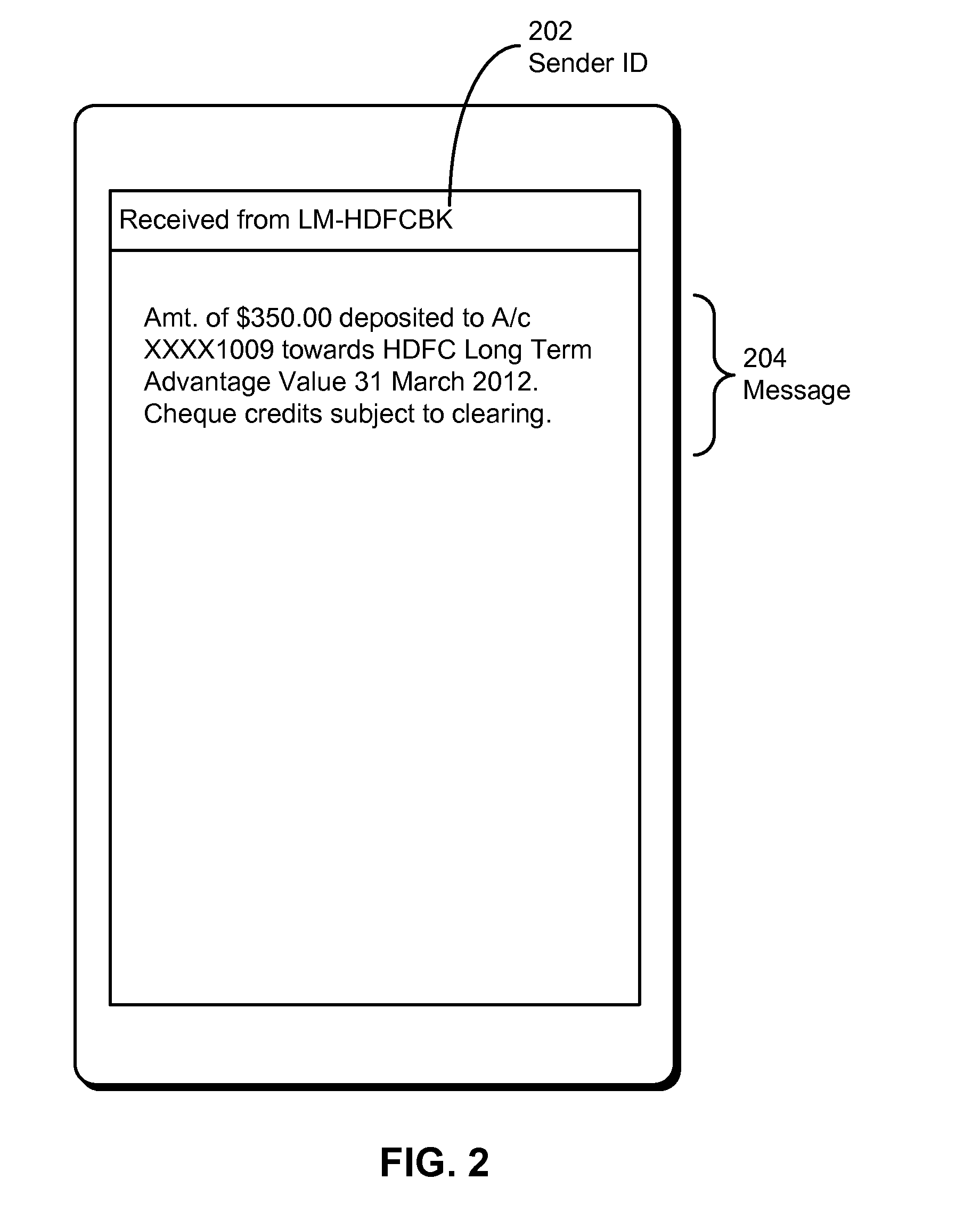

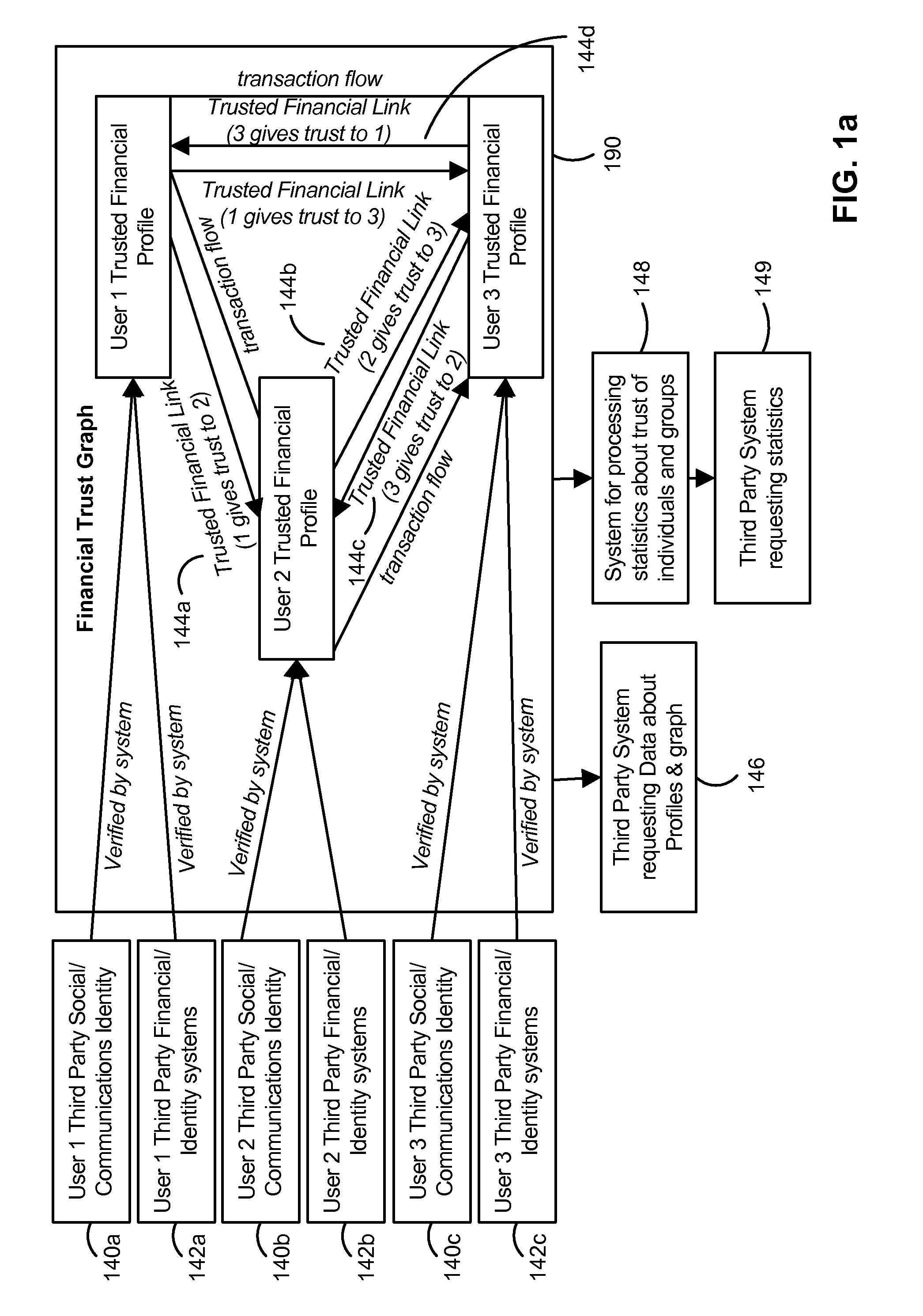

Trust Based Transaction System

A configuration for more efficient electronic financial transactions is disclosed. Users input personal and financial information into a system that validates the information to generate trusted financial profiles. Each user can establish trusted financial links with other users. The trusted financial link provides a mechanism for the user to allow other users to withdraw money from the link provider account. The data from these relationships and the financial data flowing through the system enable a measure of trustworthiness of users and the trustworthiness of all interactions in the system. The combination of trusted financial profiles, trusted financial links, and financial transactions between users create a measurable financial trust graph which is a true representation of the trusting economic relationships among the users. The financial trust graph enables a more accurate assessment of the creditworthiness and financial risk of transactions by users with little or no credit or transaction history.

Owner:PAYPAL INC

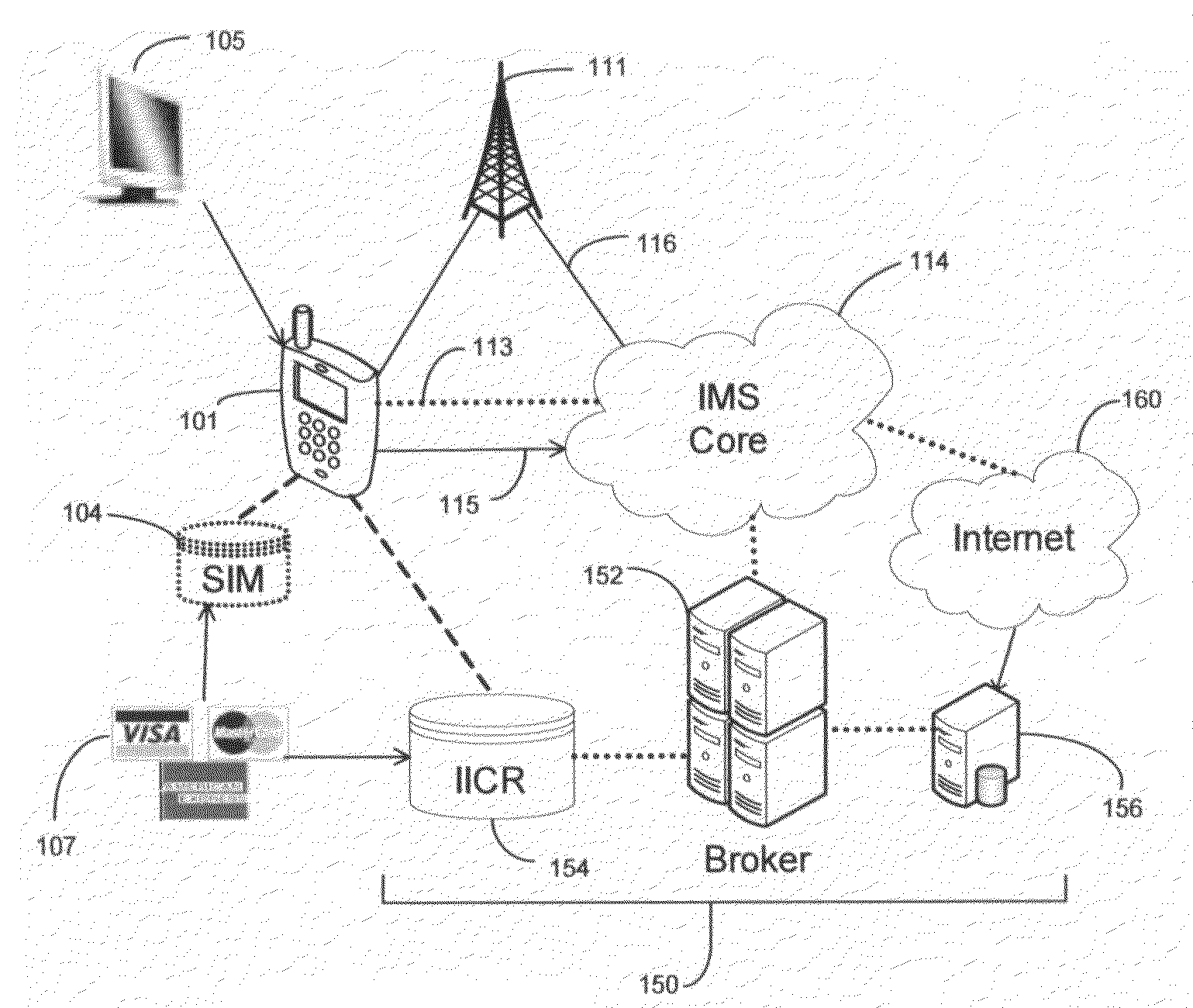

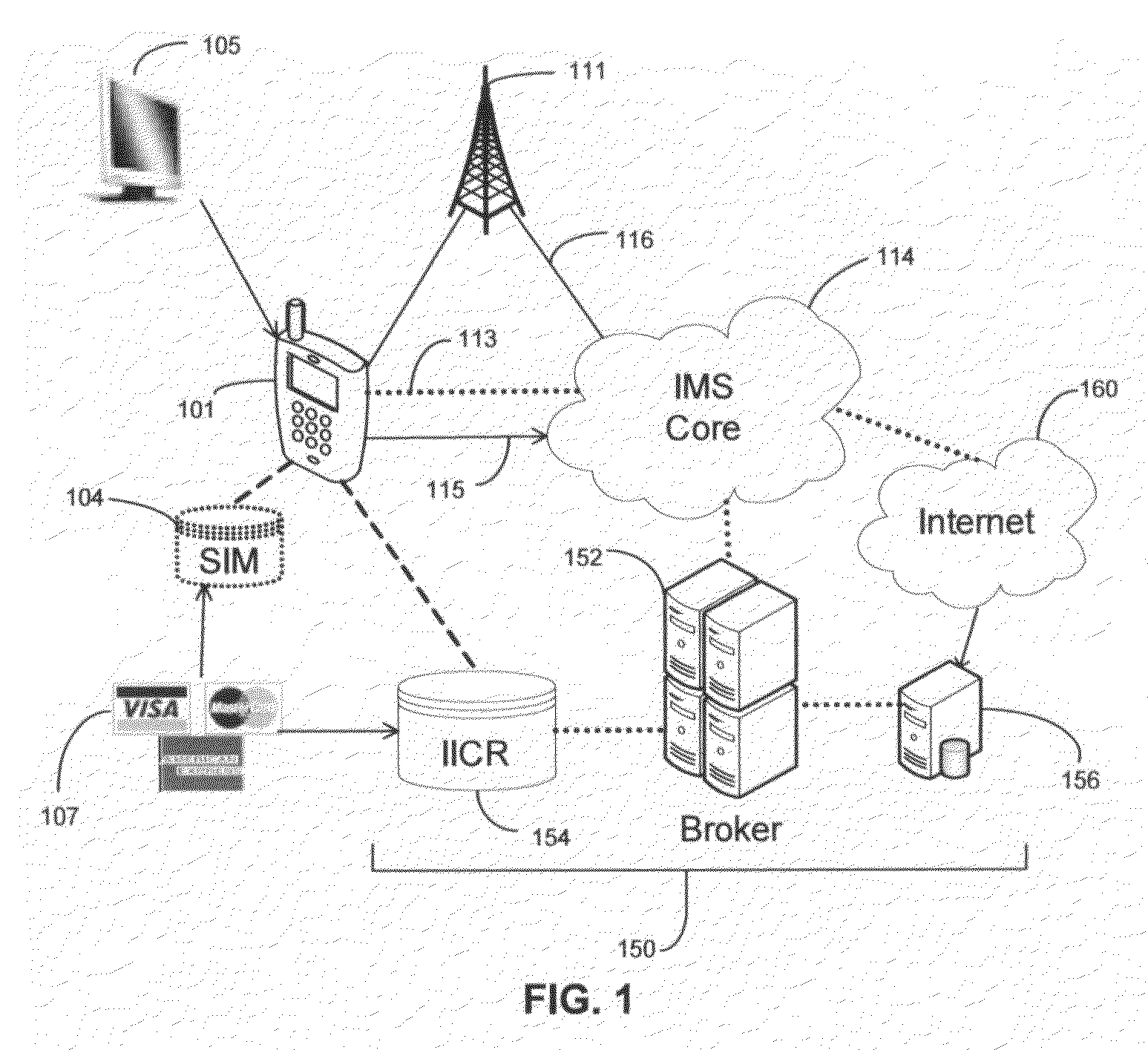

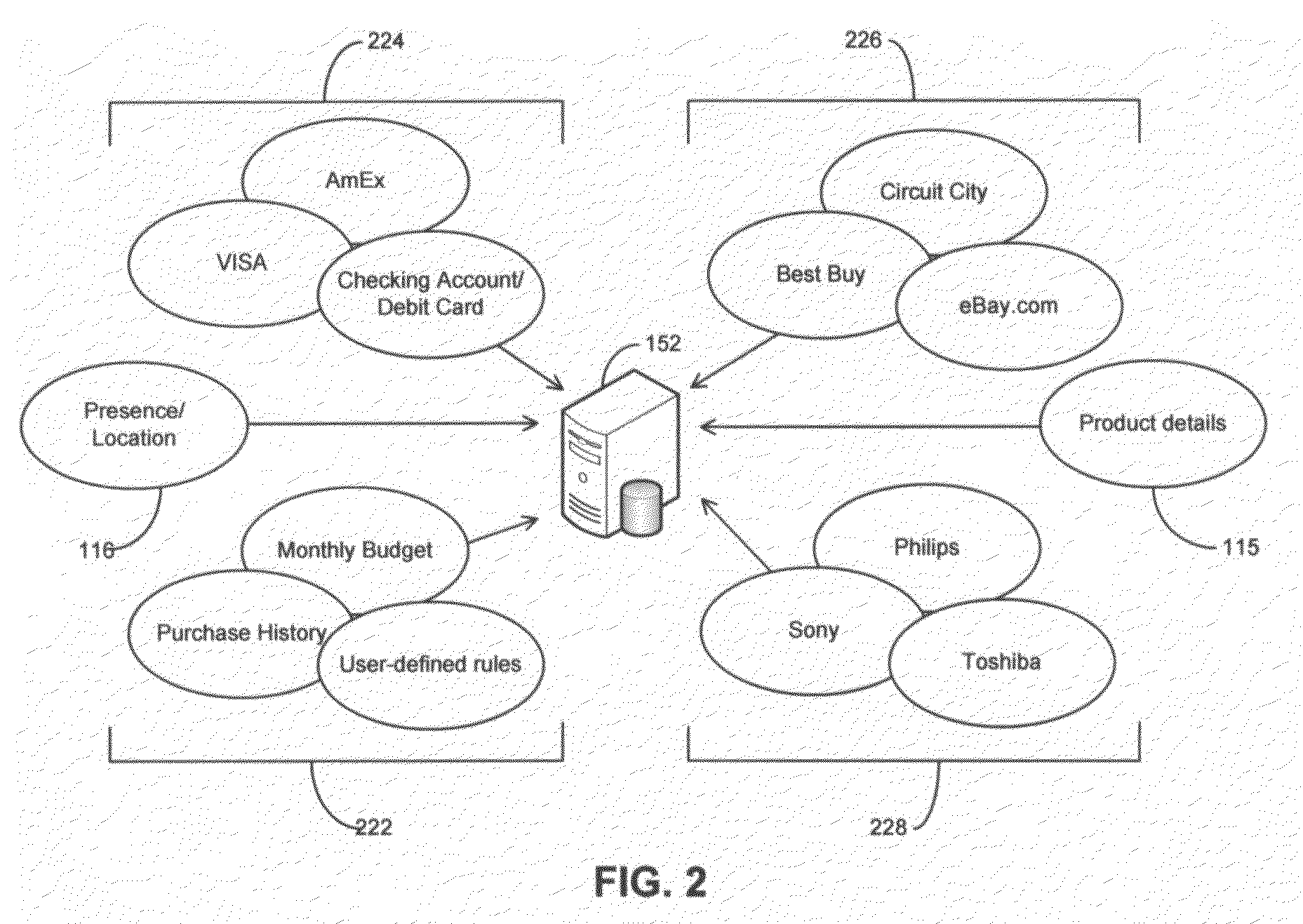

Systems and methods for profile-based mobile commerce

ActiveUS20080242274A1Minimize lagGreat dealFinanceSpecial service for subscribersSystems analysisFinancial transaction

The invention discloses systems and methods for integrating Mobile Commerce applications with dynamically generated user profiles. A profiling engine collects and stores information regarding a mobile subscriber's usage of Mobile Banking, Mobile Payment, and Mobile Brokerage, and stores the information in a profile. A Dynamic Event Server Subsystem comprising a Mobile Broker analyzes patterns in the subscriber's usage of these applications. The mobile broker can thus provide intelligent feedback regarding purchases and financial transactions back to the applications and to the subscriber. This feedback is provided in real time.

Owner:CINGULAR WIRELESS II LLC

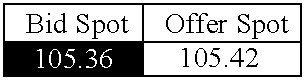

Method and apparatus for conducting financial transactions

Method and apparatus for conducting financial transactions that allows traders, market makers, dealers, and liquidity providers to negotiate with multiple customers simultaneously, and receive and respond to transaction solicitations and amendment requests in real time. The invention, which may be accessed over an interconnected data communications network, such as the Internet, using a standard Web browser, automatically provides traders with up-to-date market rates as solicitations are received, and provides a graphical user interface with sorting and filtering capabilities to organize displays to show pending and completed transactions according to user preferences. Counterparty customers engaged in transactions with the traders and dealers using the system benefit by being able to negotiate with multiple providers simultaneously, and by receiving real-time, context-sensitive transaction status messages and notifications as the negotiations take place. An optional transaction status database records transaction events in real-time and provides transaction archiving and auditing capabilities superior to conventional manual transaction systems.

Owner:FX ALLIANCE

Financial transaction network

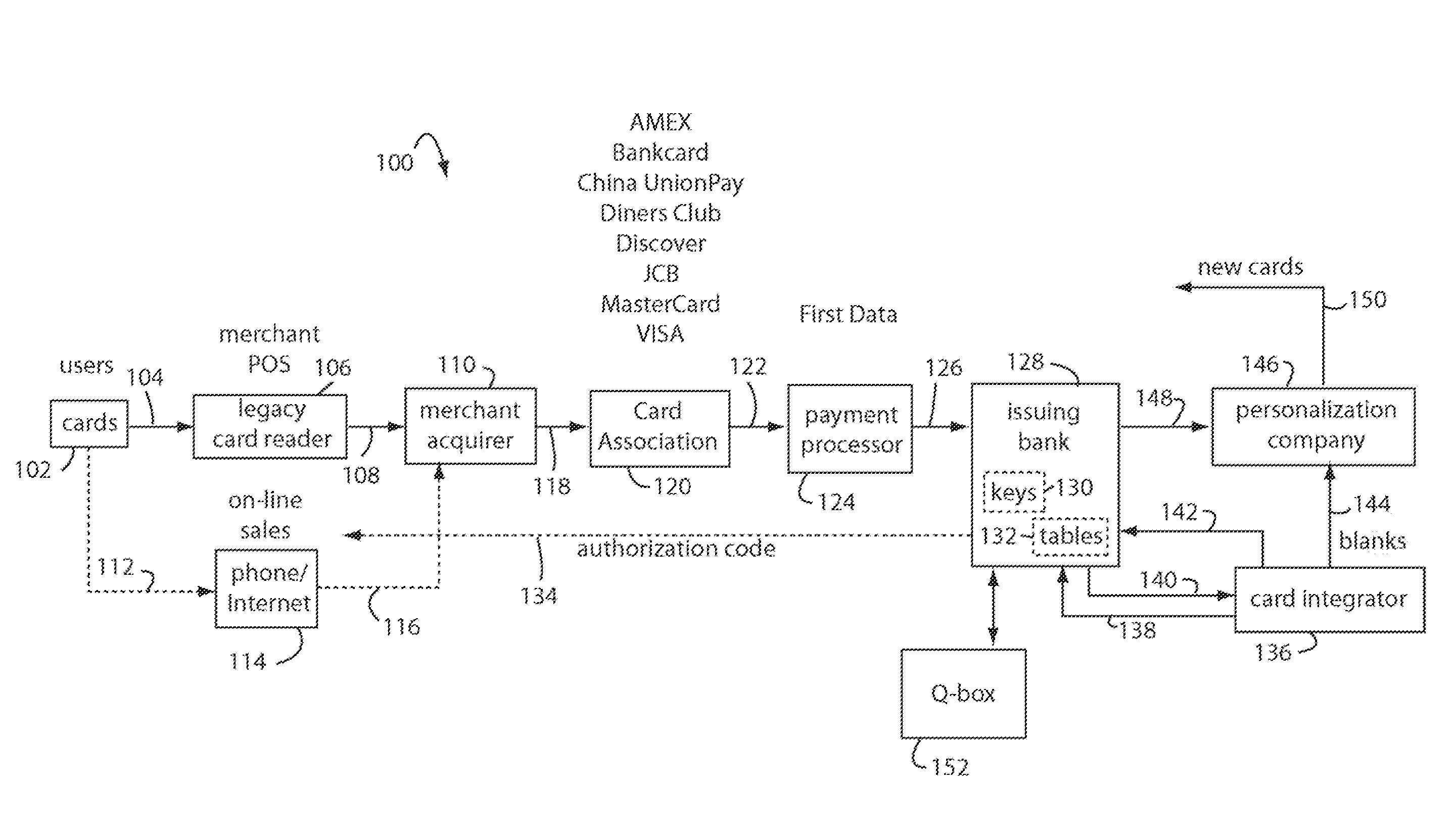

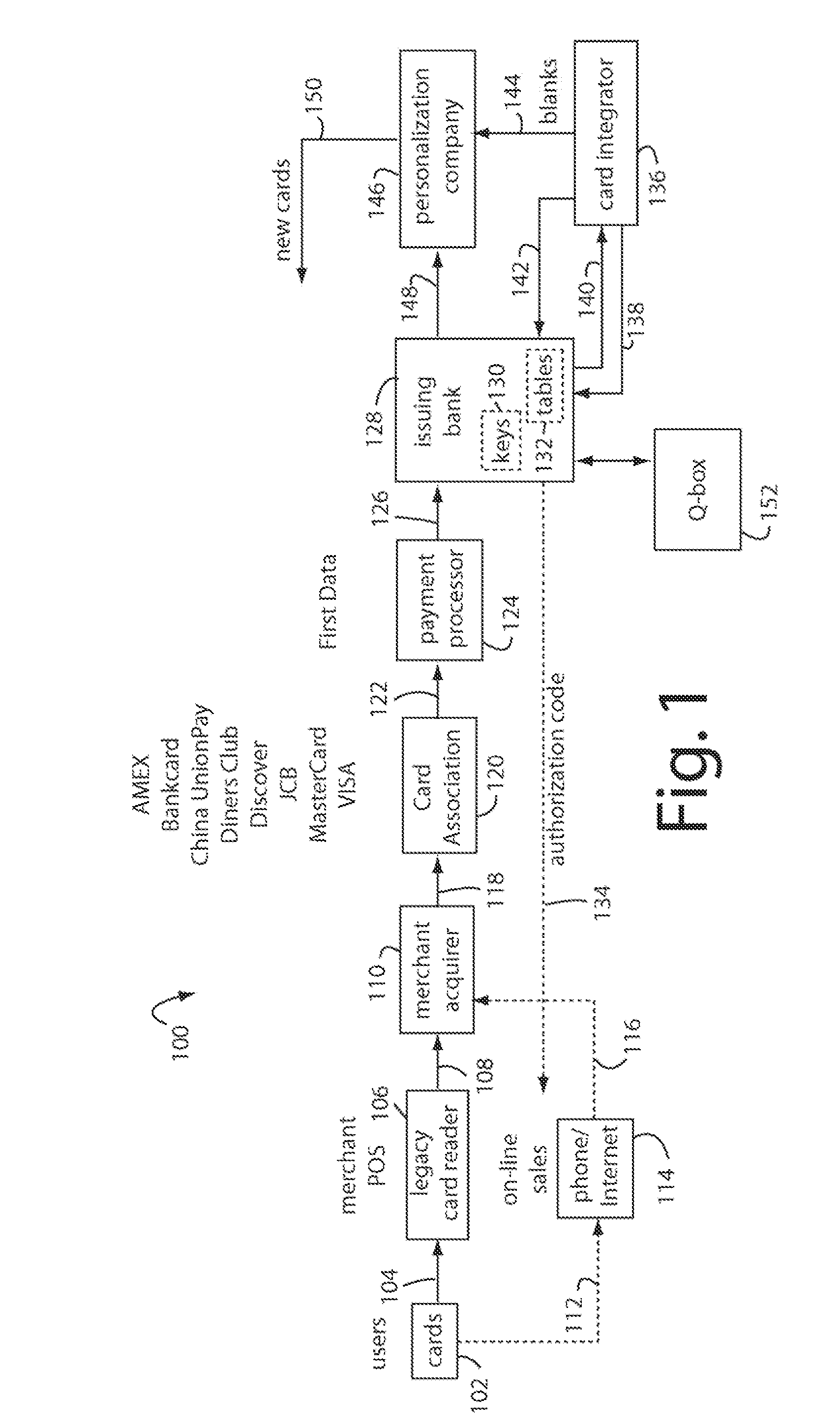

The manufacture and control of payment cards used in consumer financial transactions circulates a population of payments cards with user identification and account access codes. Each use of an individual card produces a variation of its user access code according to an encryption program seeded with encryption keys or initialization vectors. A portion of the magnetic stripe is made dynamic with a Q-Chip magnetic MEMS device. The job of personalizing payment cards with the user identification and account access codes is outsourced to a personalization company. The encryption keys and initialization vectors are kept private from the personalization company by using the encryption program to generate tables of computed results. Respective ones of the tables of computed results are sent for loading by the personalization company into new members of the population of payments cards. New payment cards are manufactured and distributed that include and operate with the tables of computed results.

Owner:FITBIT INC

Multiple account preset parameter method, apparatus and systems for financial transactions and accounts

InactiveUS20060259390A1Increased riskEasy to chargeFinanceDebit schemesFinancial transactionSmart card

Methods, apparatus and systems are provided that enables at least one debit for a financial transaction and account management features using at least two financial accounts from which such debits and / or credits can be made from said at least two financial accounts using preset financial account parameters including, but not limited to, at least one ratio, an amount threshold, a remainder threshold, a minimum available account balance, a maximum available account balance, a minimum debit amount, a range of debit amounts, a maximum debit amount, a qualitative or quantitative aspect of at least one said financial accounts, or any combination thereof, and / or other parameters, such as, but not limited to at least one threshold amount and / or remainder amount. The transaction processor also allows account debiting or account crediting parameters to be set in accordance to any merchant identifier information, and permits account balances used for a given transaction to be readjusted after said transaction has been posted. A smart card or personal identification systems embodiment of the transaction processor comprising certain capabilities of the global financial card account embodiment is also provided.

Owner:ROSENBERGER RONALD J

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com