Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

3018 results about "Parsing" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Parsing, syntax analysis, or syntactic analysis is the process of analysing a string of symbols, either in natural language, computer languages or data structures, conforming to the rules of a formal grammar. The term parsing comes from Latin pars (orationis), meaning part (of speech).

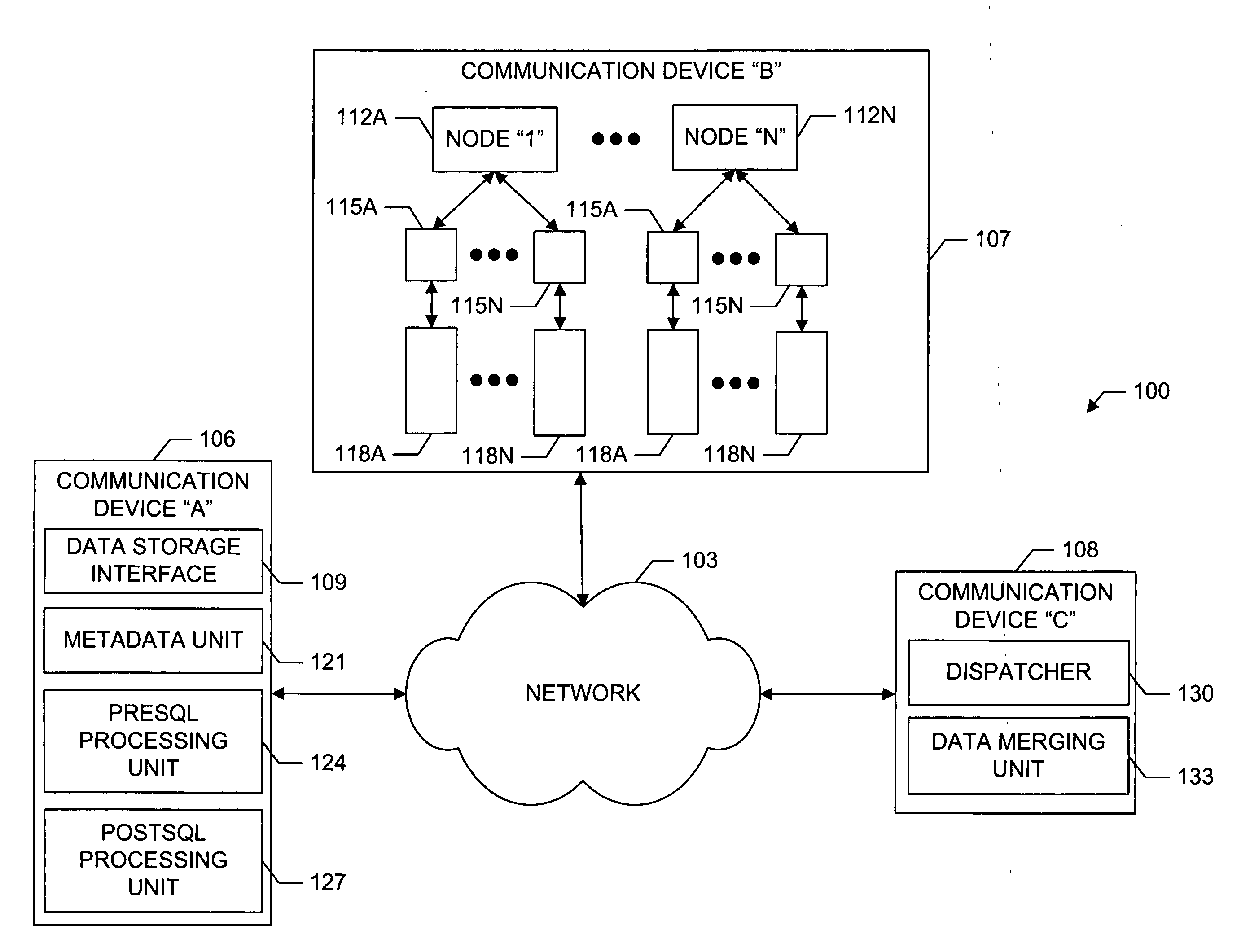

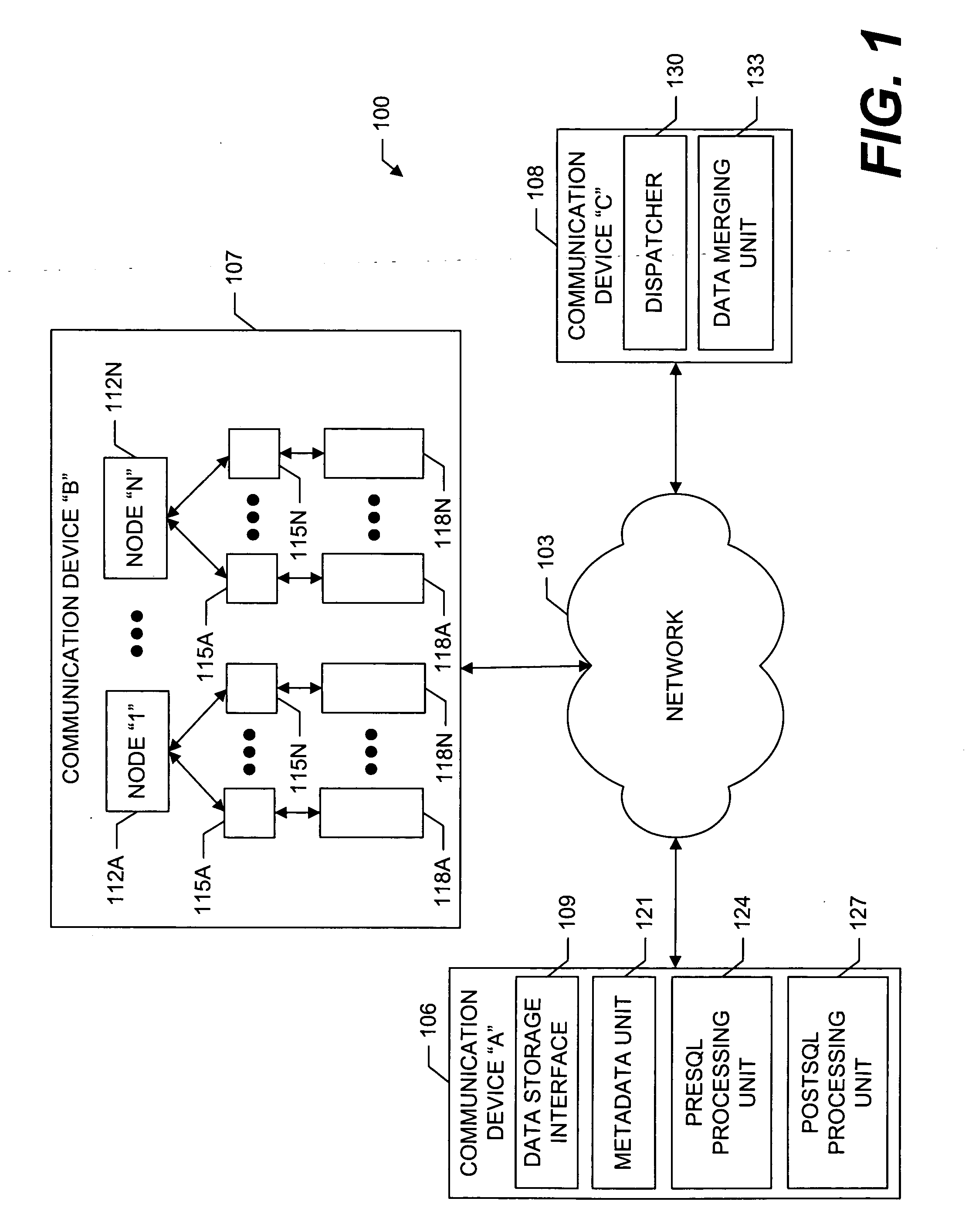

System and methods for facilitating a linear grid database with data organization by dimension

InactiveUS20060224603A1Data processing applicationsMulti-dimensional databasesGrid managementData storing

A system and methods for organizing and querying data within a linear grid management system. Data having multiple dimensions is associated with physical locations, where a first dimension is associated with a node and a second dimension is associated with a data storage identifier of a memory storage device. The data may have a third dimension which provides a field for ordering data within the memory storage device. Metadata may be used to map a logical table to data stored in the memory storage device. The data query may be divided into multiple subqueries, wherein each subquery is related directly to one node associated with a data storage identifier related to a memory storage device. A preSQL and postSQL process may be generated to access an external database. A dispatcher may manage data subrequests and a node may generate a unique and efficient parsing process from the received data subrequest.

Owner:WALMART APOLLO LLC

Intelligent home automation

InactiveUS20100332235A1Electric signal transmission systemsMultiple keys/algorithms usageSpoken languageThe Internet

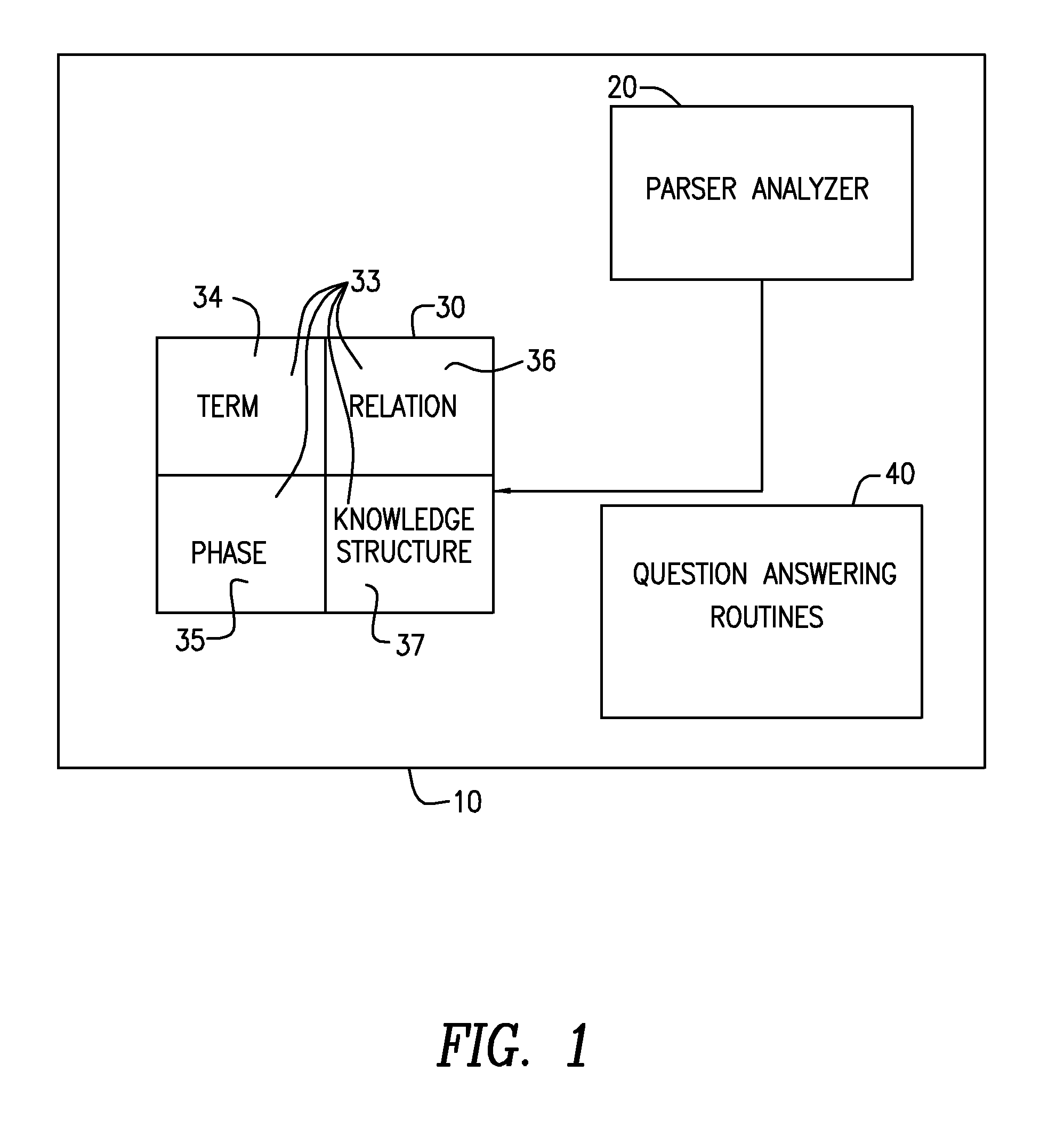

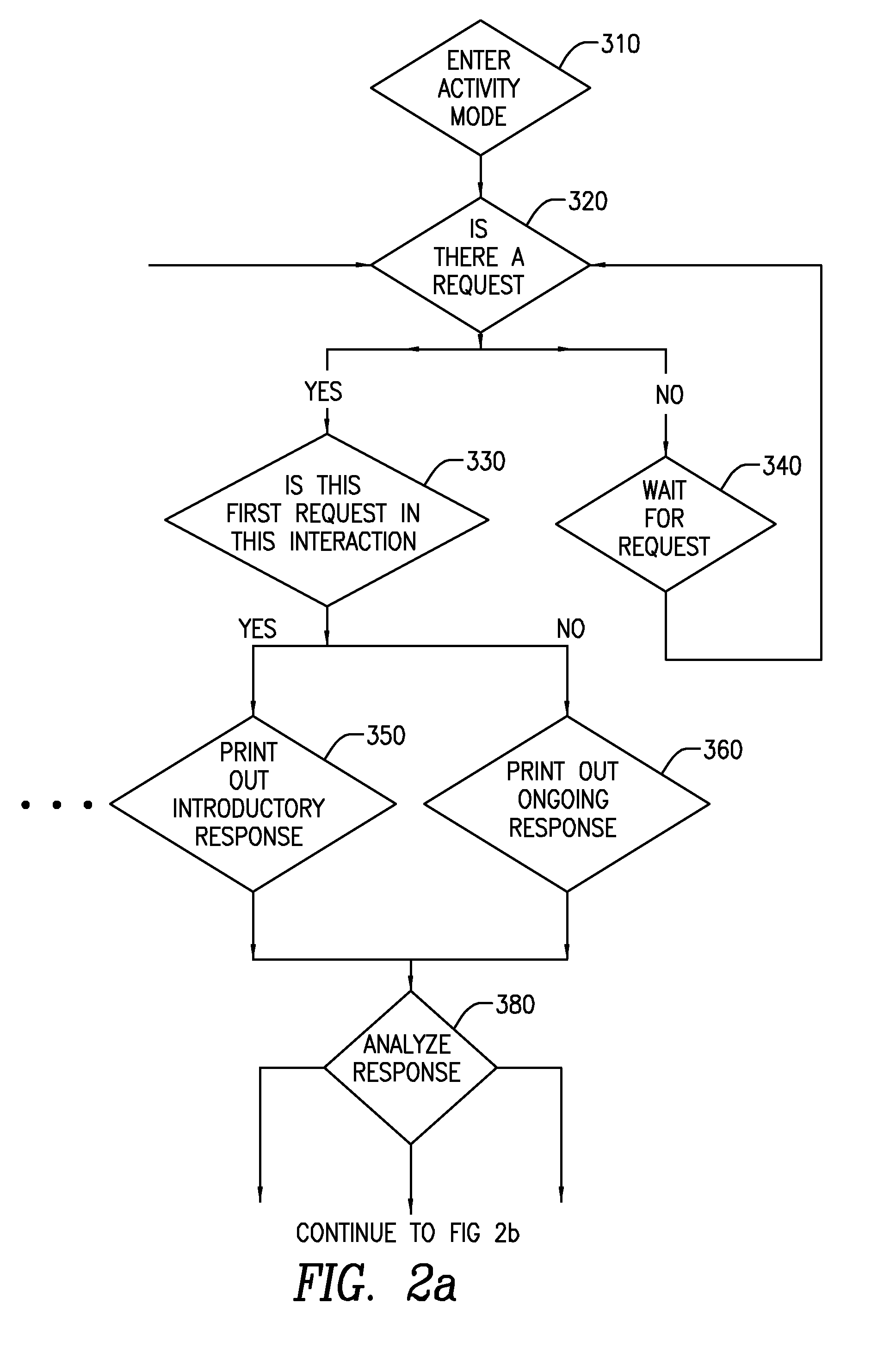

An intelligent home automation system answers questions of a user speaking “natural language” located in a home. The system is connected to, and may carry out the user's commands to control, any circuit, object, or system in the home. The system can answer questions by accessing the Internet. Using a transducer that “hears” human pulses, the system may be able to identify, announce and keep track of anyone entering or staying in the home or participating in a conversation, including announcing their identity in advance. The system may interrupt a conversation to implement specific commands and resume the conversation after implementation. The system may have extensible memory structures for term, phrase, relation and knowledge, question answering routines and a parser analyzer that uses transformational grammar and a modified three hypothesis analysis. The parser analyzer can be dormant unless spoken to. The system has emergency modes for prioritization of commands.

Owner:DAVID ABRAHAM BEN

Audio and video decoder circuit and system

InactiveUS6369855B1Accelerates memory block moveAvoid confictTelevision system detailsPulse modulation television signal transmissionCoprocessorNetwork packet

An improved audio-visual circuit is provided that includes a transport packet parsing circuit for receiving a transport data packet stream, a CPU circuit for initializing said integrated circuit and for processing portions of said data packet stream, a ROM circuit for storing data, a RAM circuit for storing data, an audio decoder circuit for decoding audio portions of said data packet stream, a video decoder circuit for decoding video portions of said data packet stream, an NTSC / PAL encoding circuit for encoding video portions of said data packet stream, an OSD coprocessor circuit for processing OSD portions of said data packets, a traffic controller circuit moving portions of said data packet stream between portions of said integrated circuit, an extension bus interface circuit, a P1394 interface circuit, a communication coprocessors circuit, an address bus connected to said circuits, and a data bus connected to said circuits.

Owner:TEXAS INSTR INC

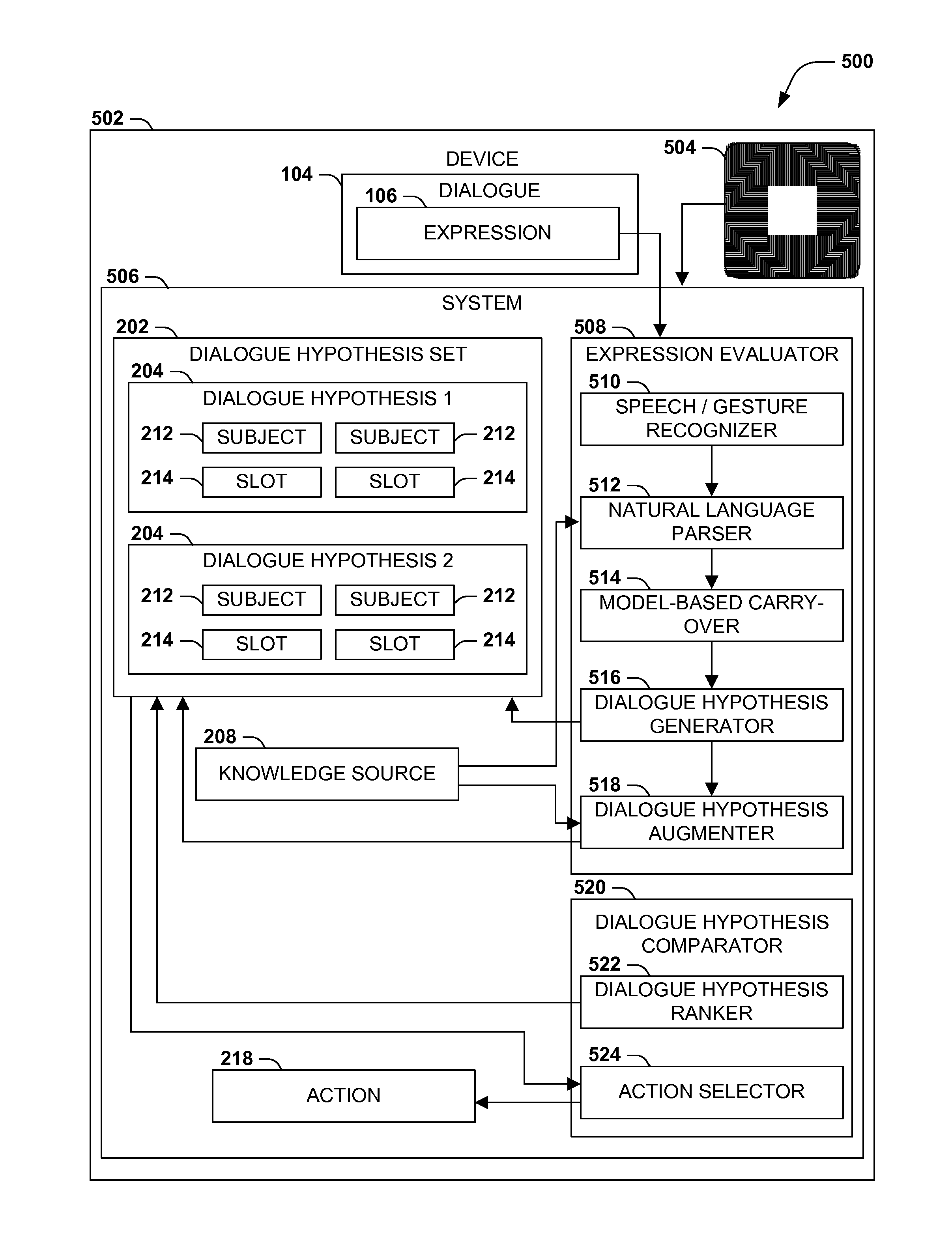

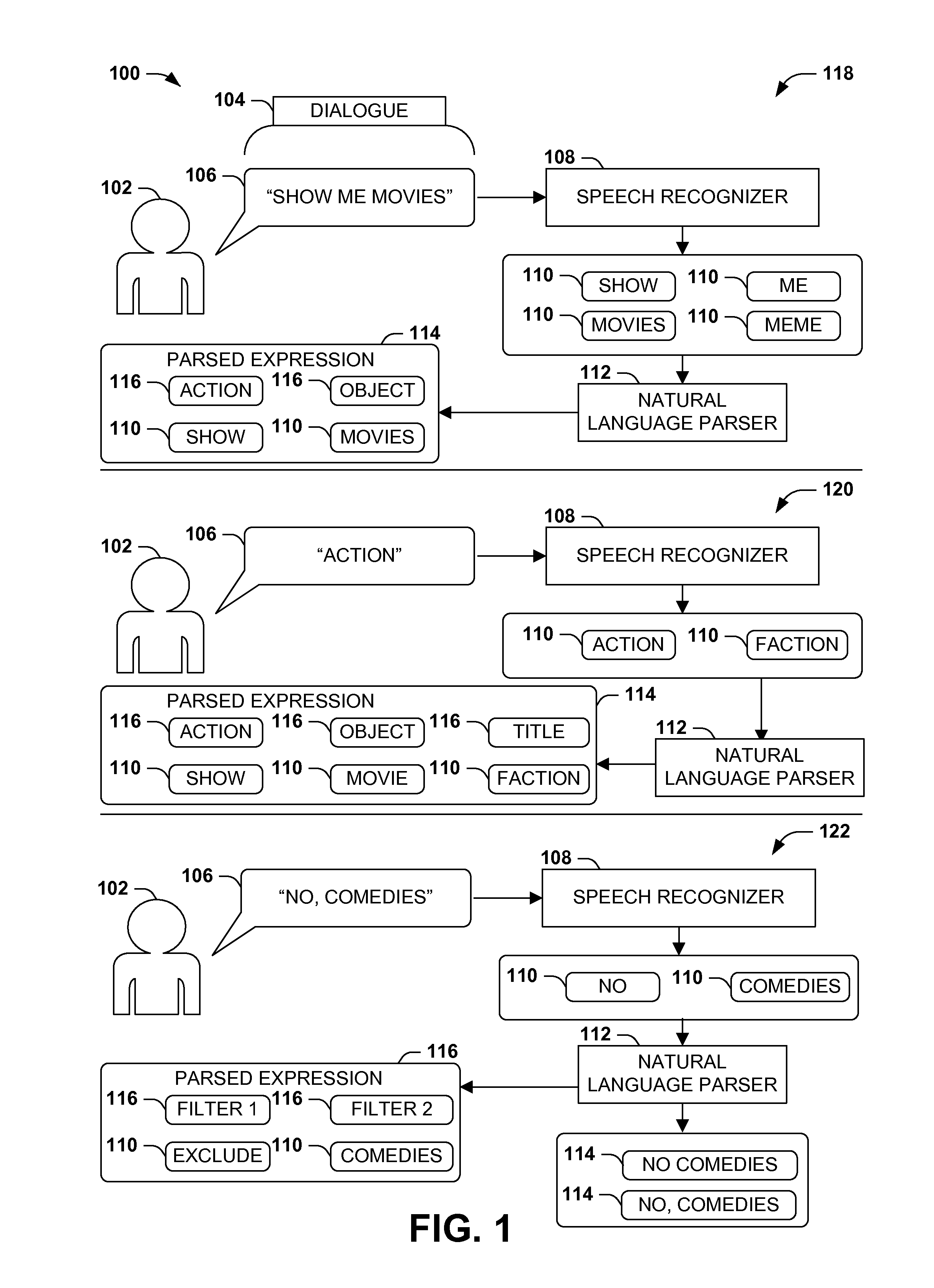

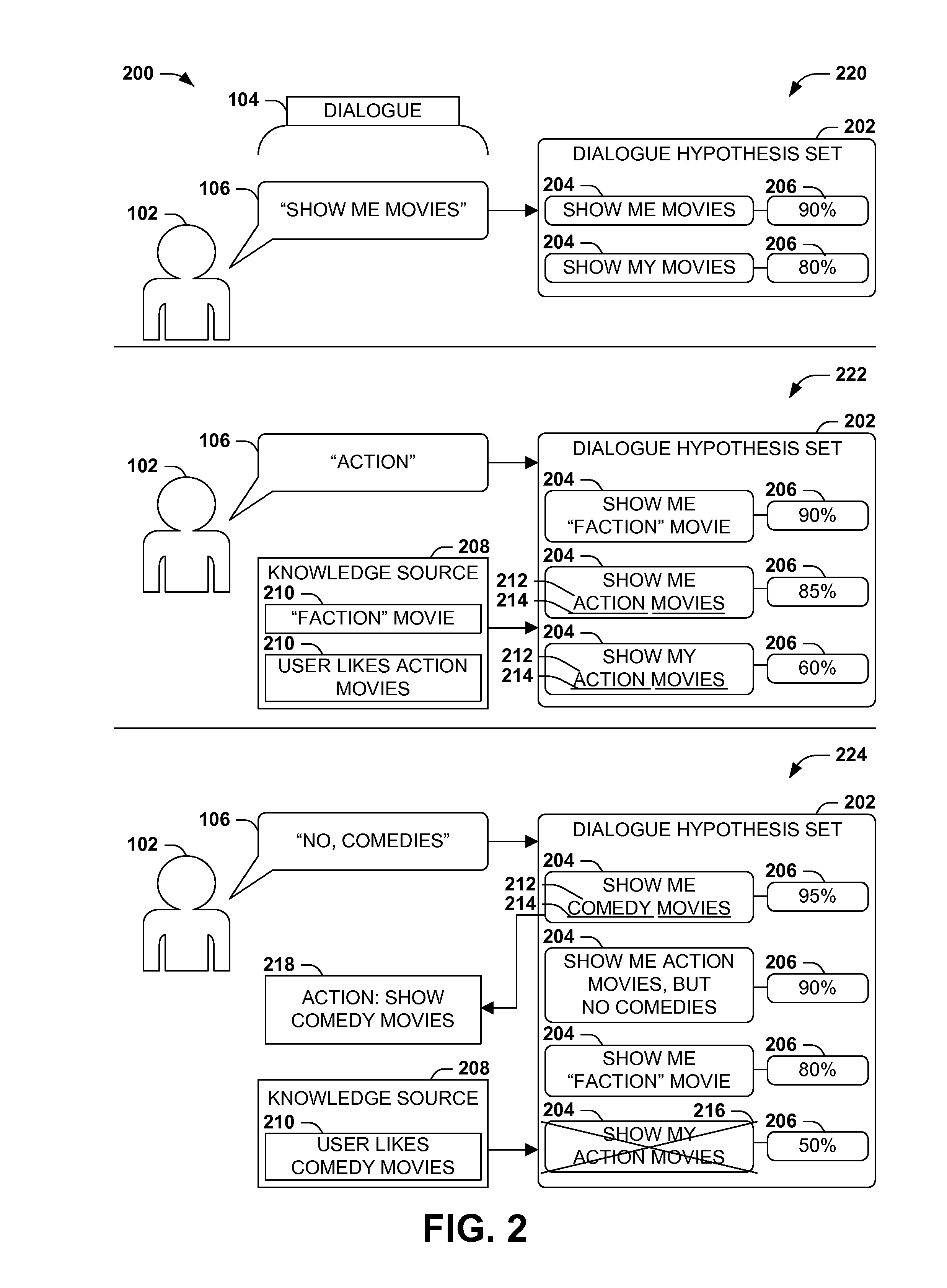

Dialogue evaluation via multiple hypothesis ranking

ActiveUS20150142420A1Reduce settingsNatural language data processingSpeech recognitionKnowledge sourcesMultiple hypothesis

In language evaluation systems, user expressions are often evaluated by speech recognizers and language parsers, and among several possible translations, a highest-probability translation is selected and added to a dialogue sequence. However, such systems may exhibit inadequacies by discarding alternative translations that may initially exhibit a lower probability, but that may have a higher probability when evaluated in the full context of the dialogue, including subsequent expressions. Presented herein are techniques for communicating with a user by formulating a dialogue hypothesis set identifying hypothesis probabilities for a set of dialogue hypotheses, using generative and / or discriminative models, and repeatedly re-ranks the dialogue hypotheses based on subsequent expressions. Additionally, knowledge sources may inform a model-based with a pre-knowledge fetch that facilitates pruning of the hypothesis search space at an early stage, thereby enhancing the accuracy of language parsing while also reducing the latency of the expression evaluation and economizing computing resources.

Owner:MICROSOFT TECH LICENSING LLC

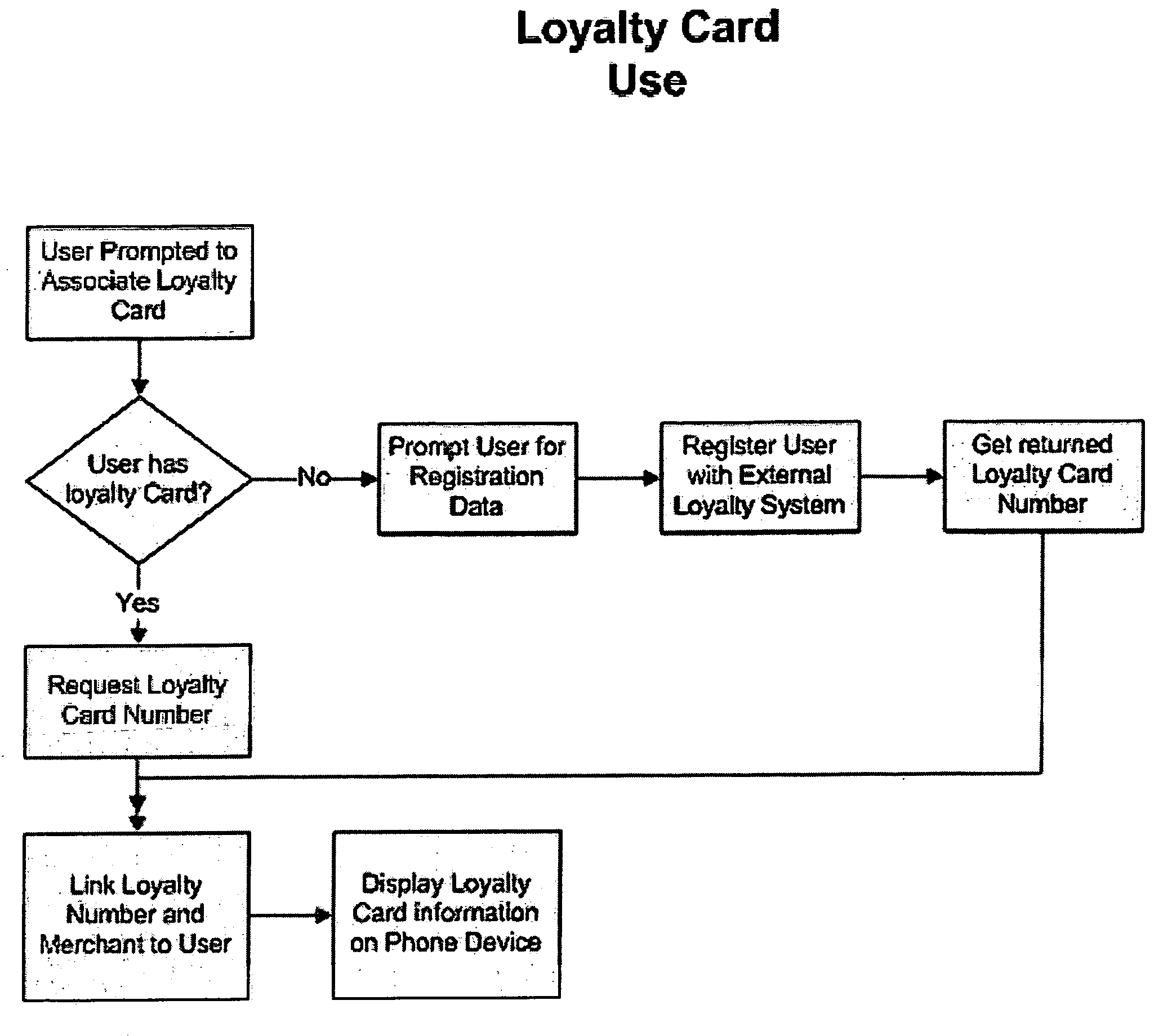

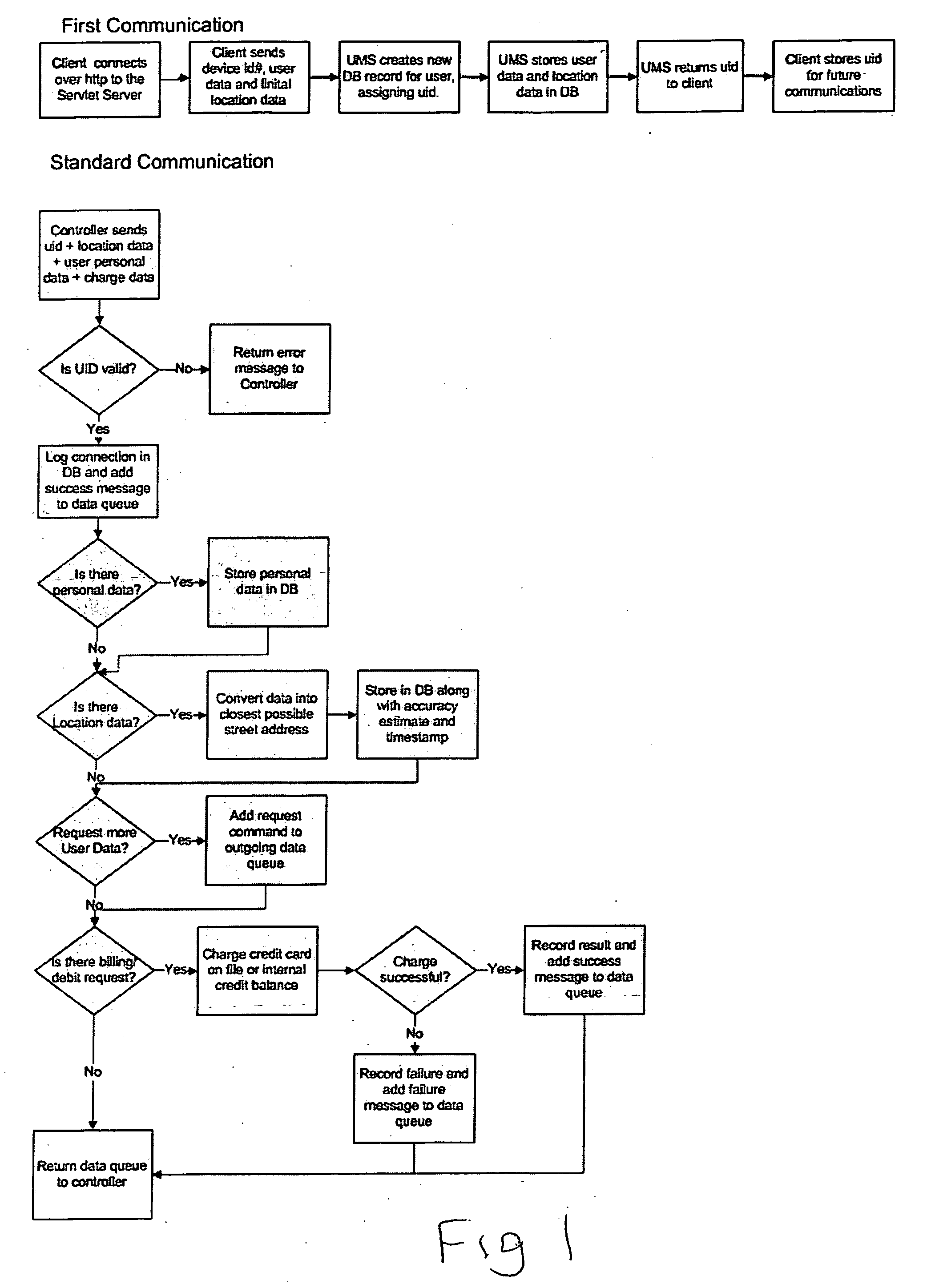

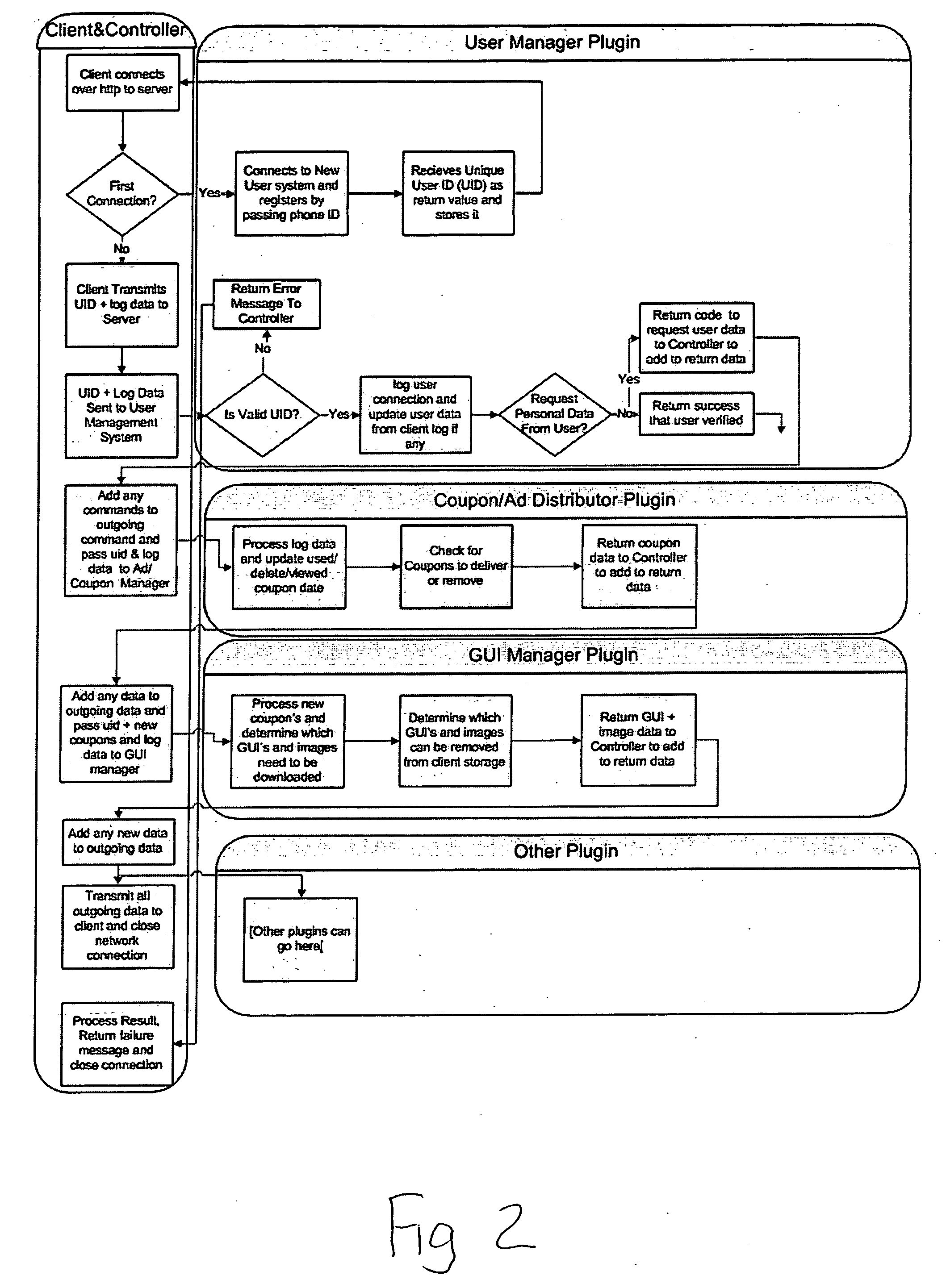

Delivering targeted advertising to mobile devices

InactiveUS20060190331A1Simple methodEasy to manageDigital data information retrievalAdvertisementsTargeted advertisingClient-side

A method of delivering advertising items to a client at a portable device is provided. A client ID is sent to a host server. A downloaded advertising item is produced relative to a product or service from the host server. The downloaded advertising item is parsed and stored. In response to the parsing and storing, displaying the advertising item is displayed to the client at the mobile device.

Owner:CELLFIRE

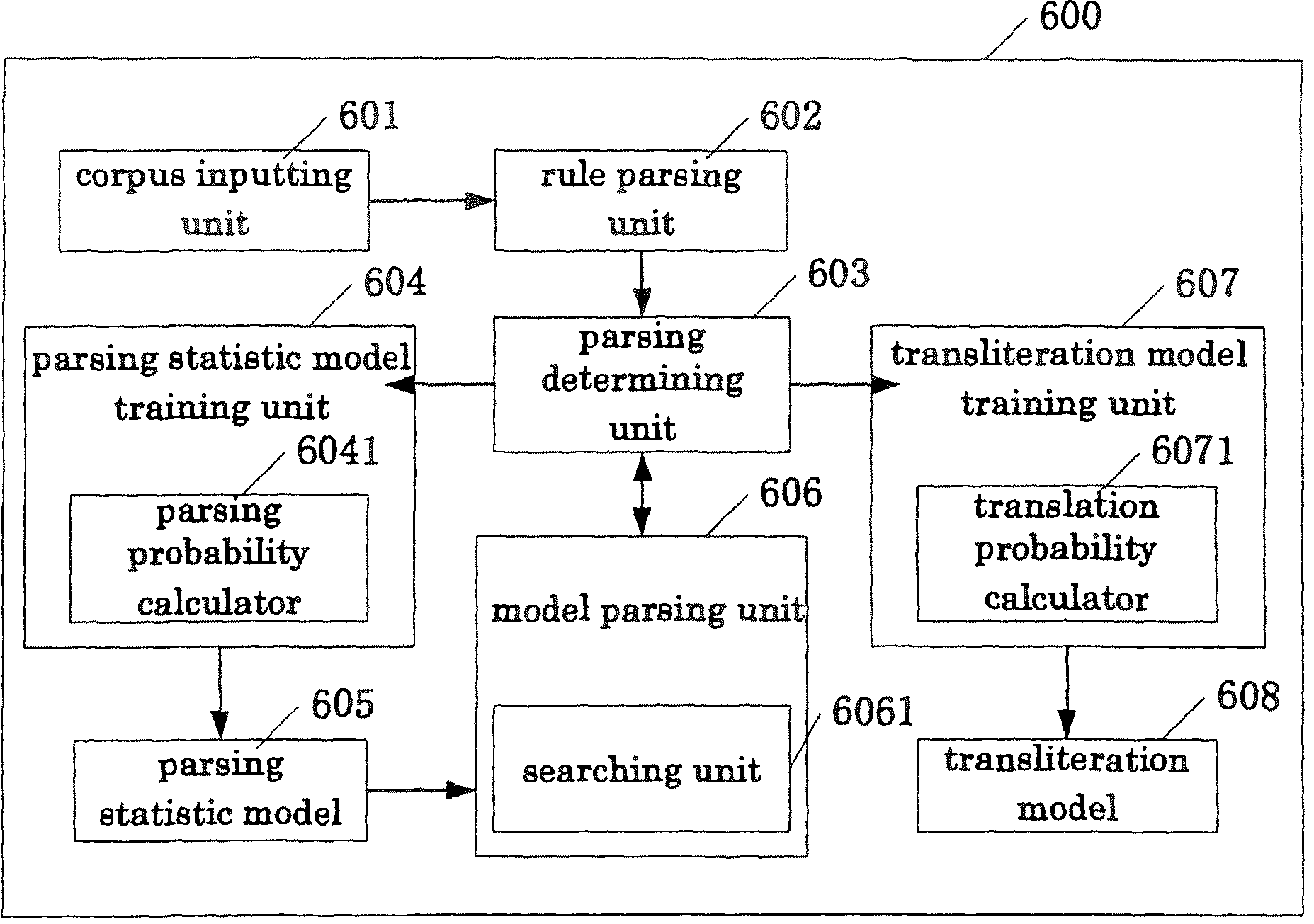

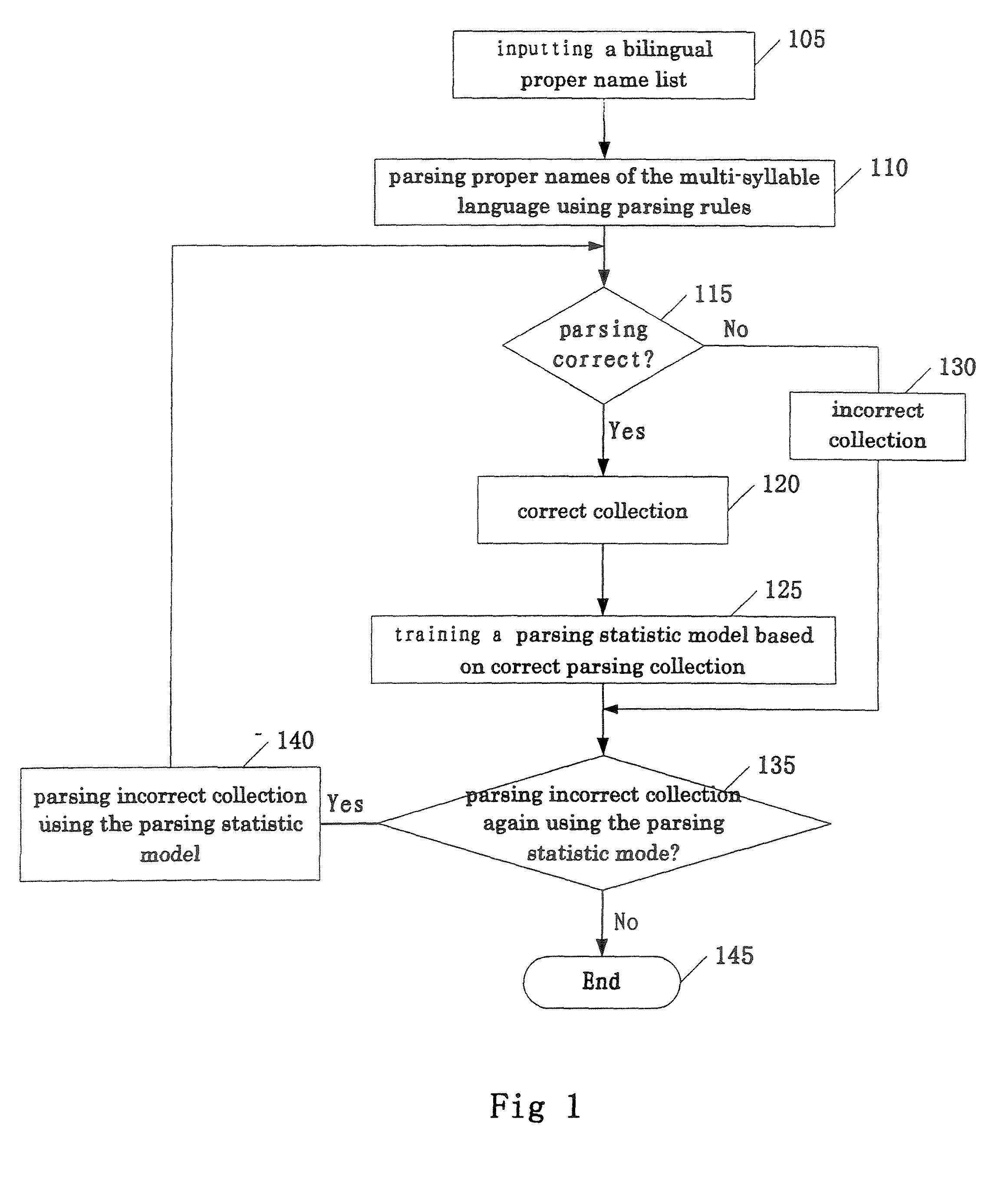

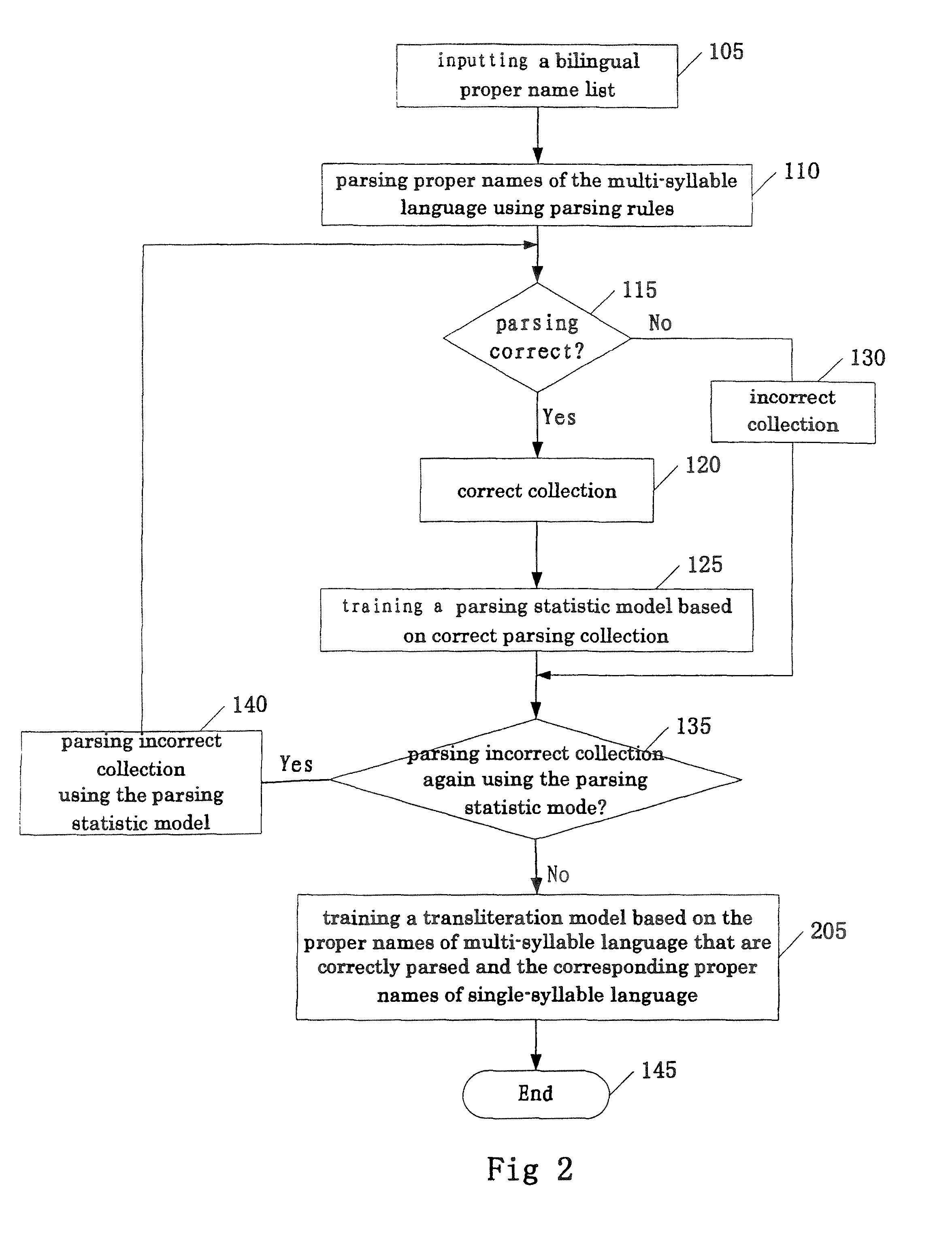

Method and apparatus for training transliteration model and parsing statistic model, method and apparatus for transliteration

The present invention provides a method and apparatus for training a parsing statistic model, a method and apparatus for transliteration. Said parsing statistic model is to be used in transliteration between a single-syllable language and a multi-syllable language and includes sub-syllable parsing probabilities of said multi-syllable language. Said method for training the parsing statistic model comprising: inputting a bilingual proper name list as corpus, said bilingual proper name list includes a plurality of proper names of said multi-syllable language and corresponding proper names of said single-syllable language respectively; parsing each of said plurality of proper names of multi-syllable language in said bilingual proper name list into a sub-syllable sequence using parsing rules; determining whether said parsing is correct according to the corresponding proper name of said single-syllable language in said bilingual proper name list; and training said parsing statistic model base on the result of parsing that is determined as correct.

Owner:KK TOSHIBA

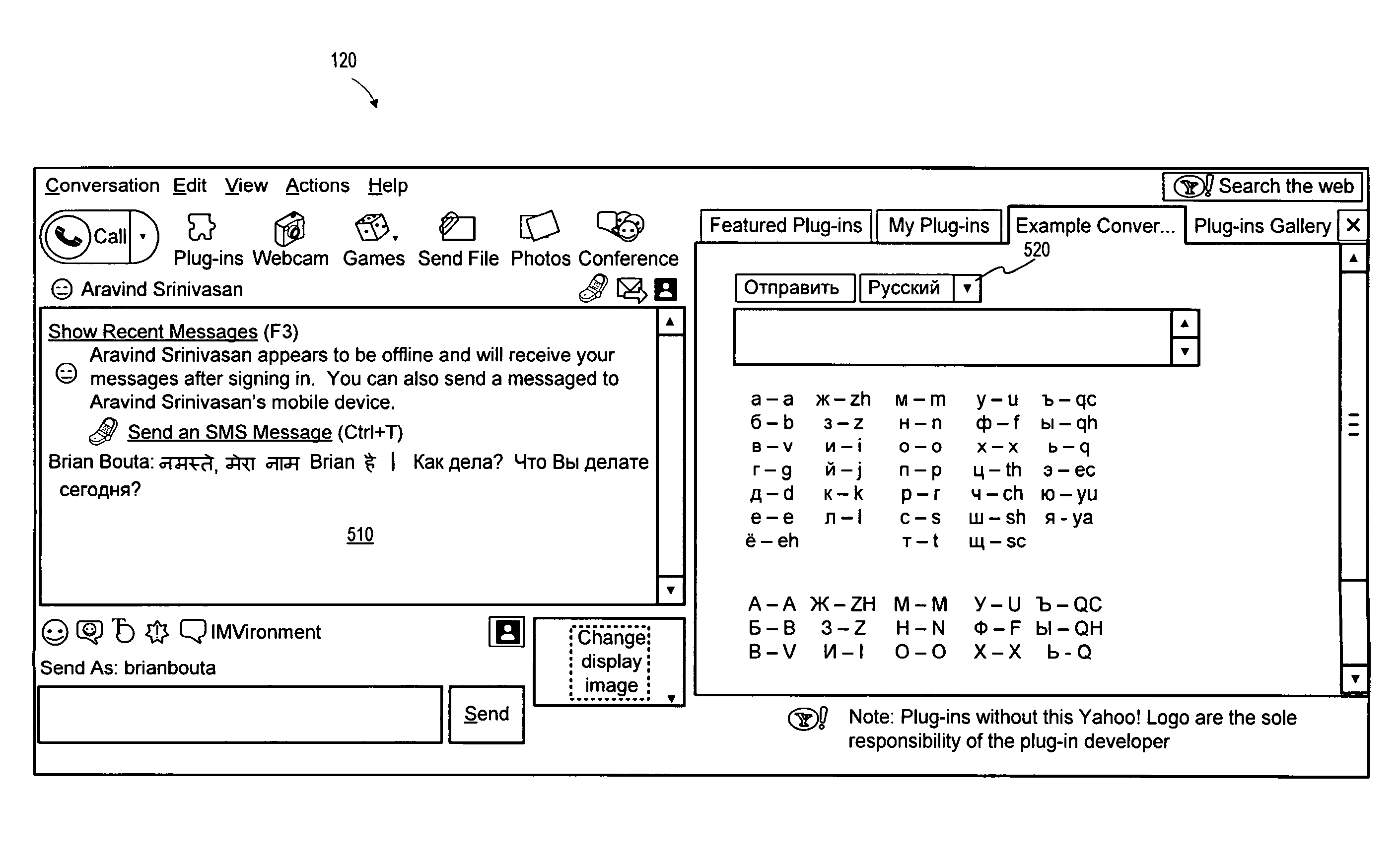

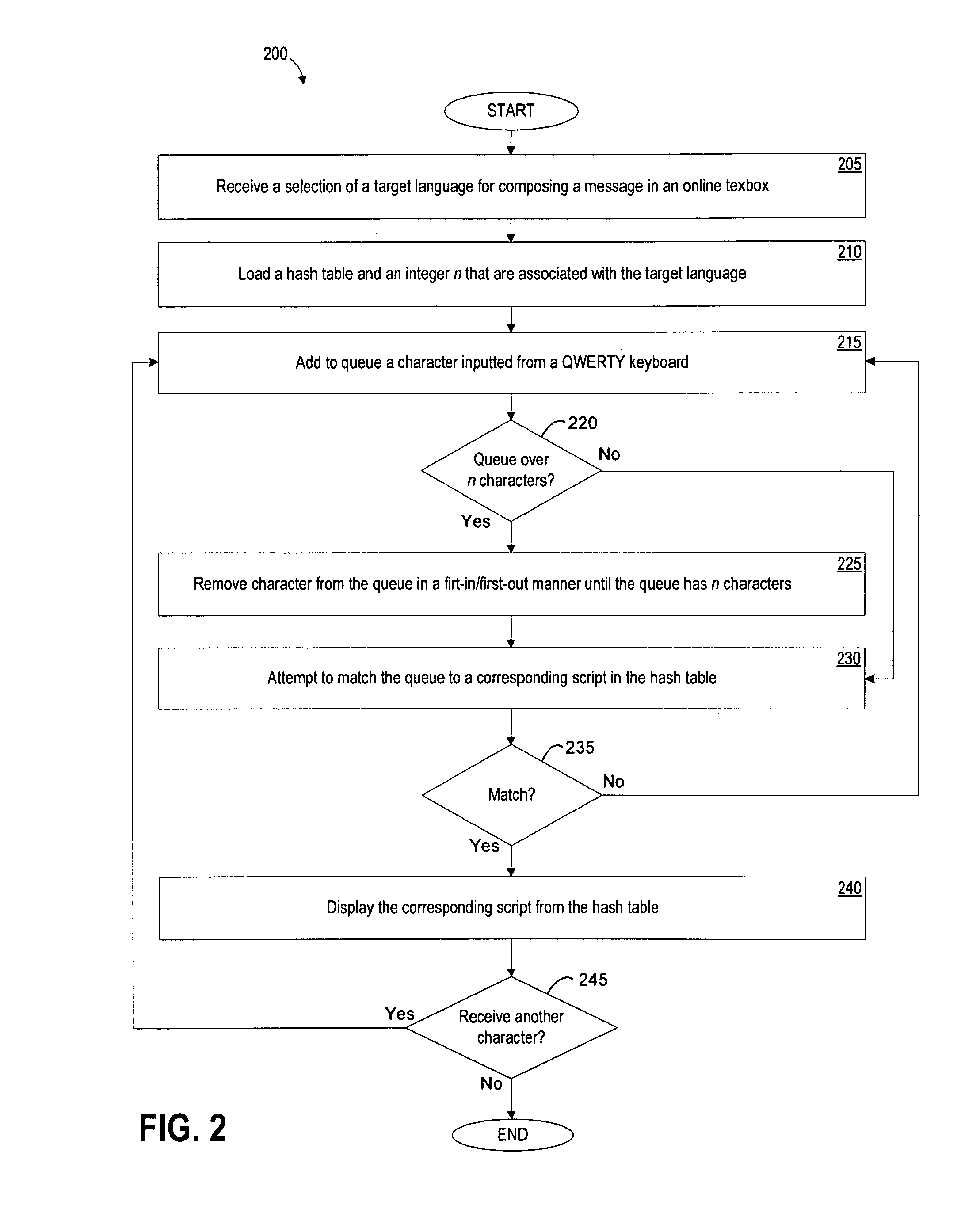

Composing a message in an online textbox using a non-latin script

ActiveUS8122353B2Input/output for user-computer interactionSpeech analysisLatin scriptMapping techniques

A method and an apparatus are provided for composing a message in an online textbox using a non-Latin script. In one example, the method includes receiving a selection of a target language for composing the message in the online textbox, loading a hash table and an integer n that are associated with the target language, adding to a queue a character inputted from a QWERTY keyboard, and applying appropriate parsing and mapping techniques to the queue using the hash table and the integer n to display an appropriate script of the target language.

Owner:YAHOO ASSETS LLC

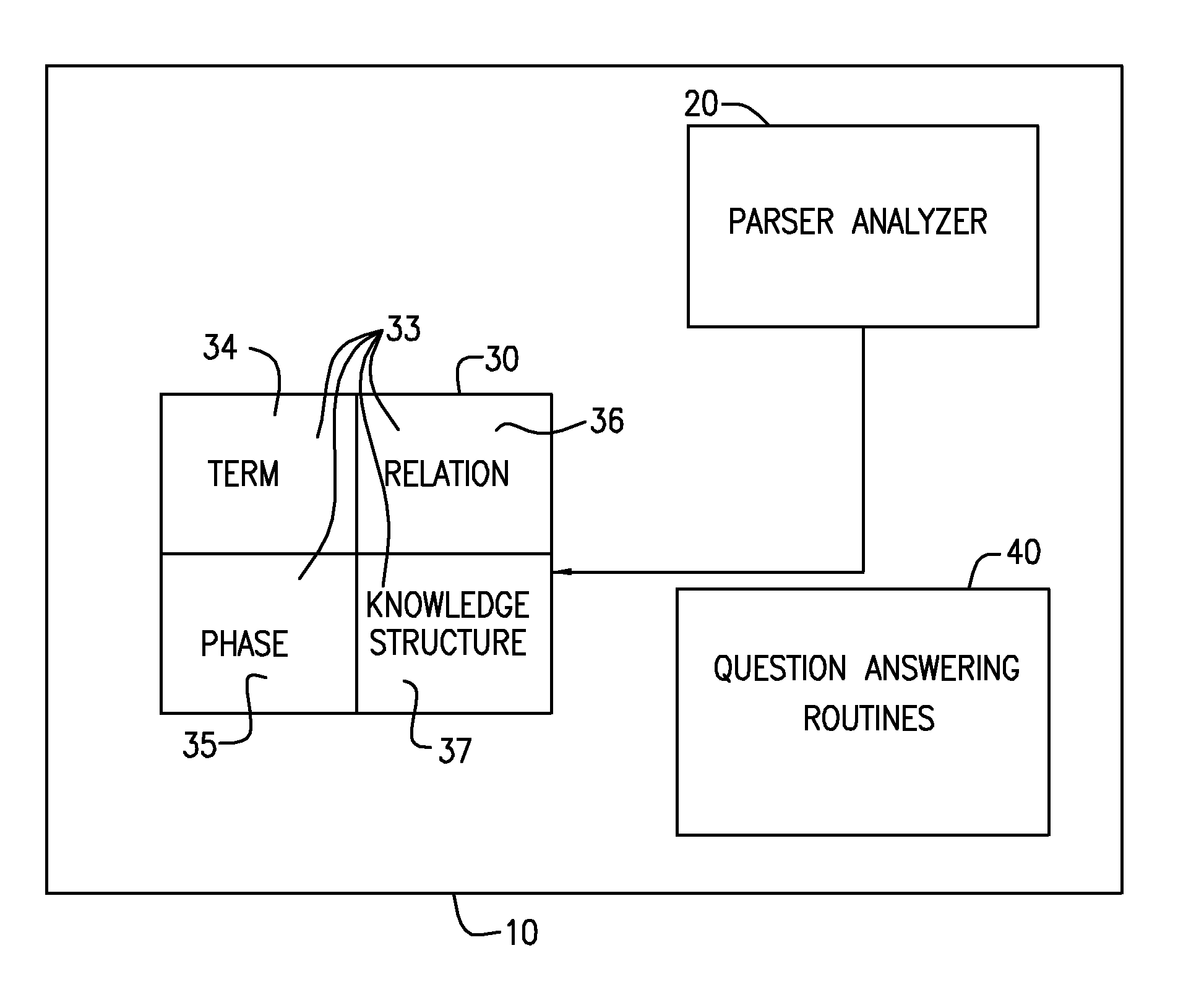

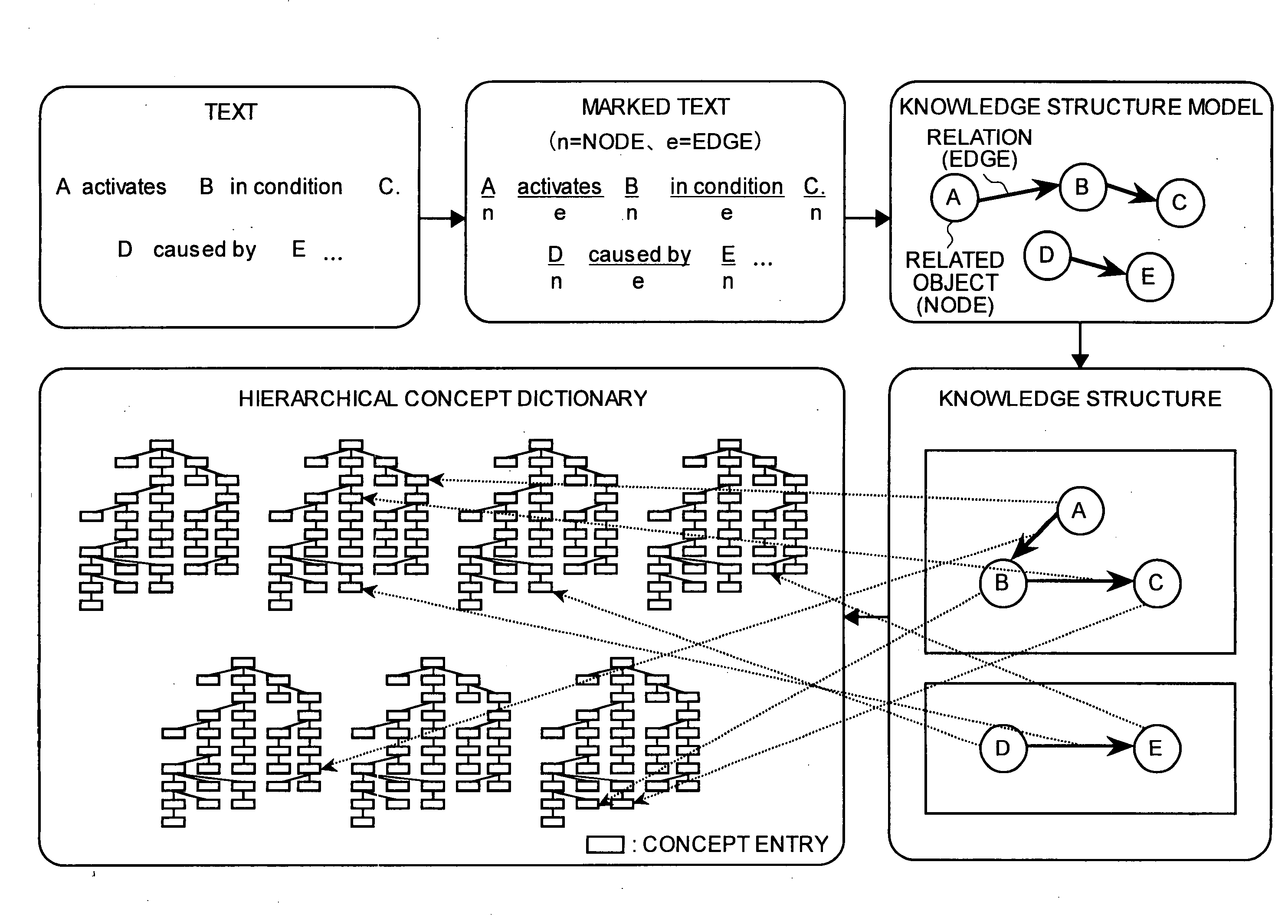

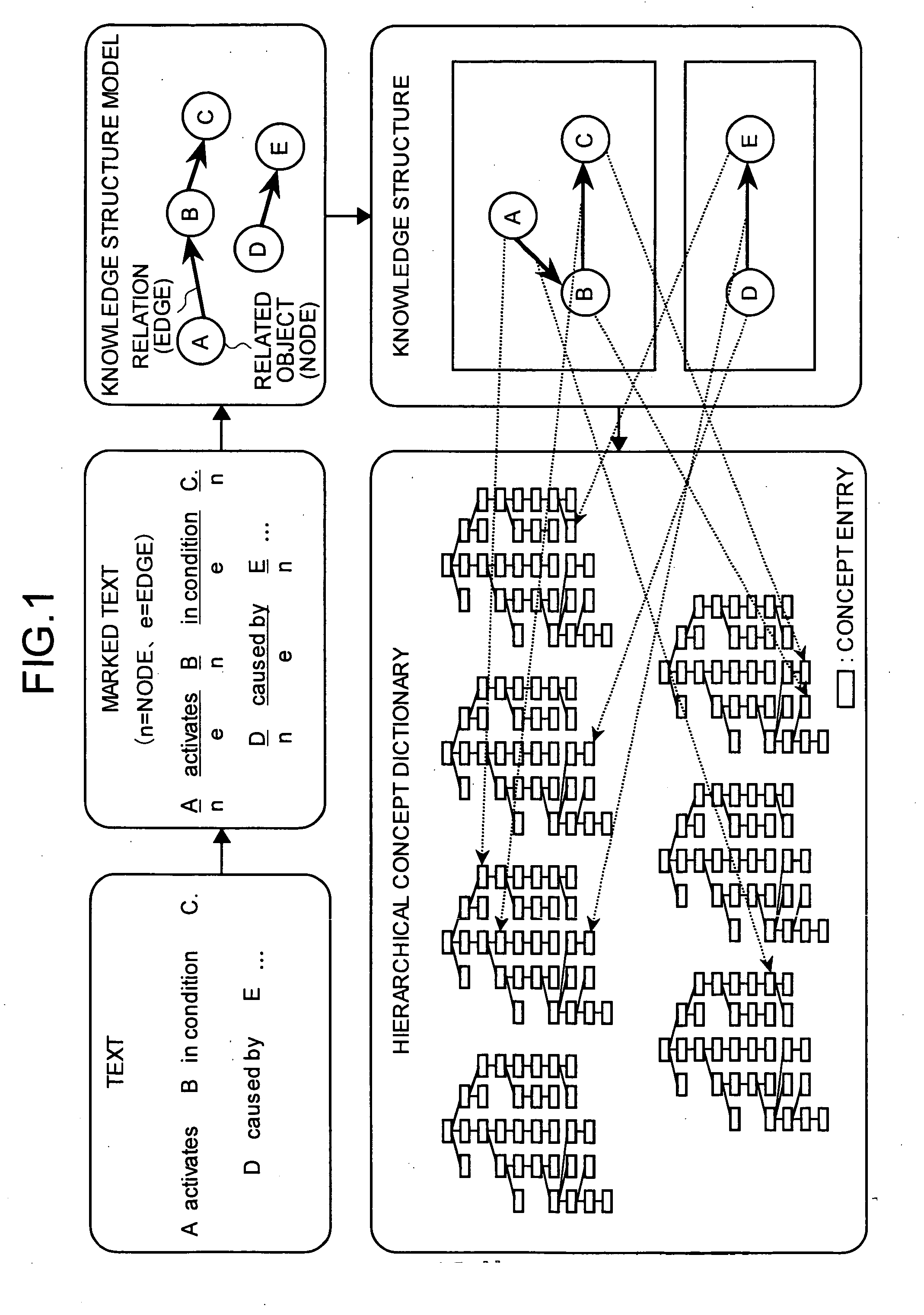

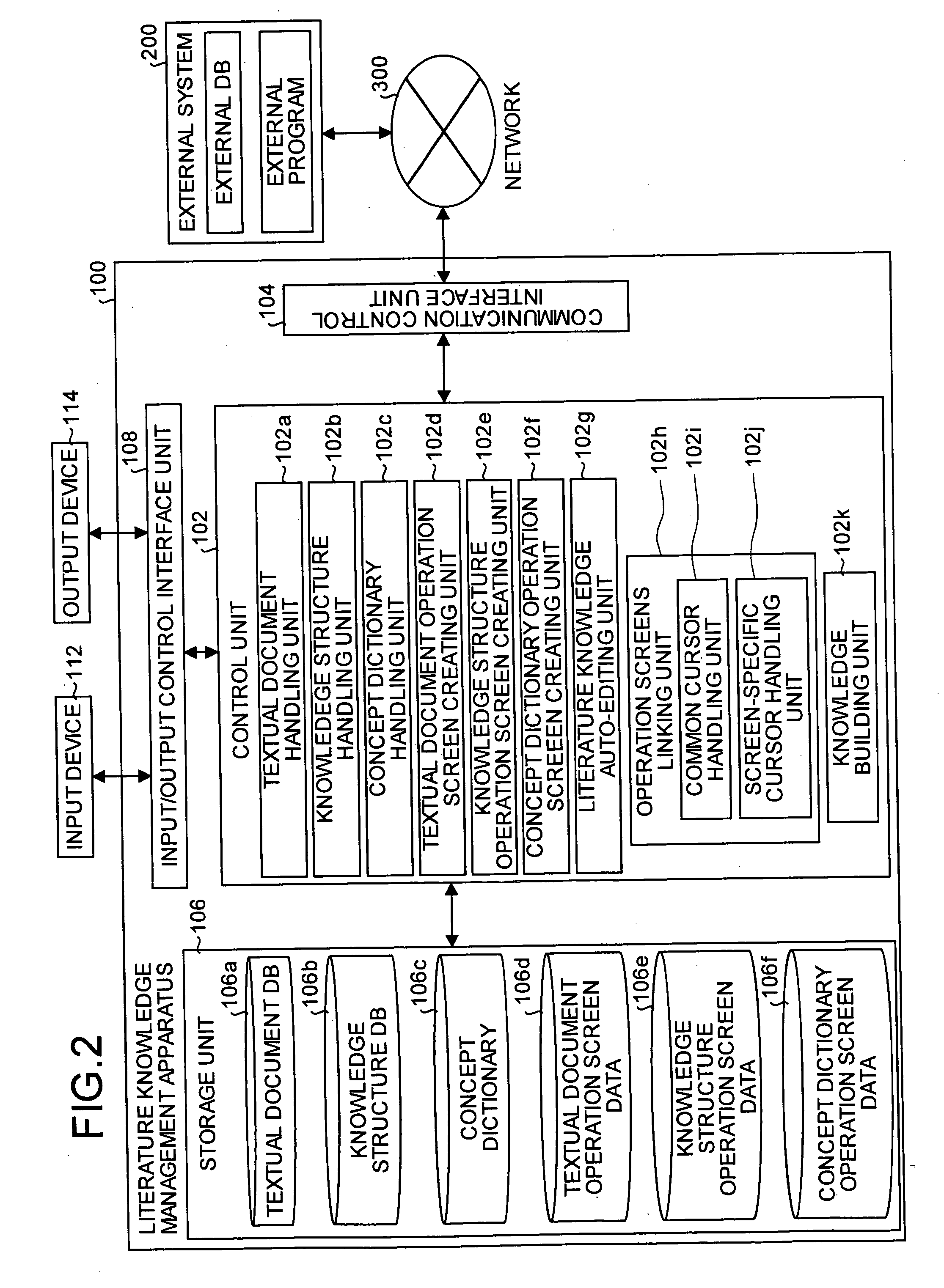

Document knowledge management apparatus and method

InactiveUS20050154690A1Efficient processingEasily correlatedDigital computer detailsUnstructured textual data retrievalPart of speechGraphics

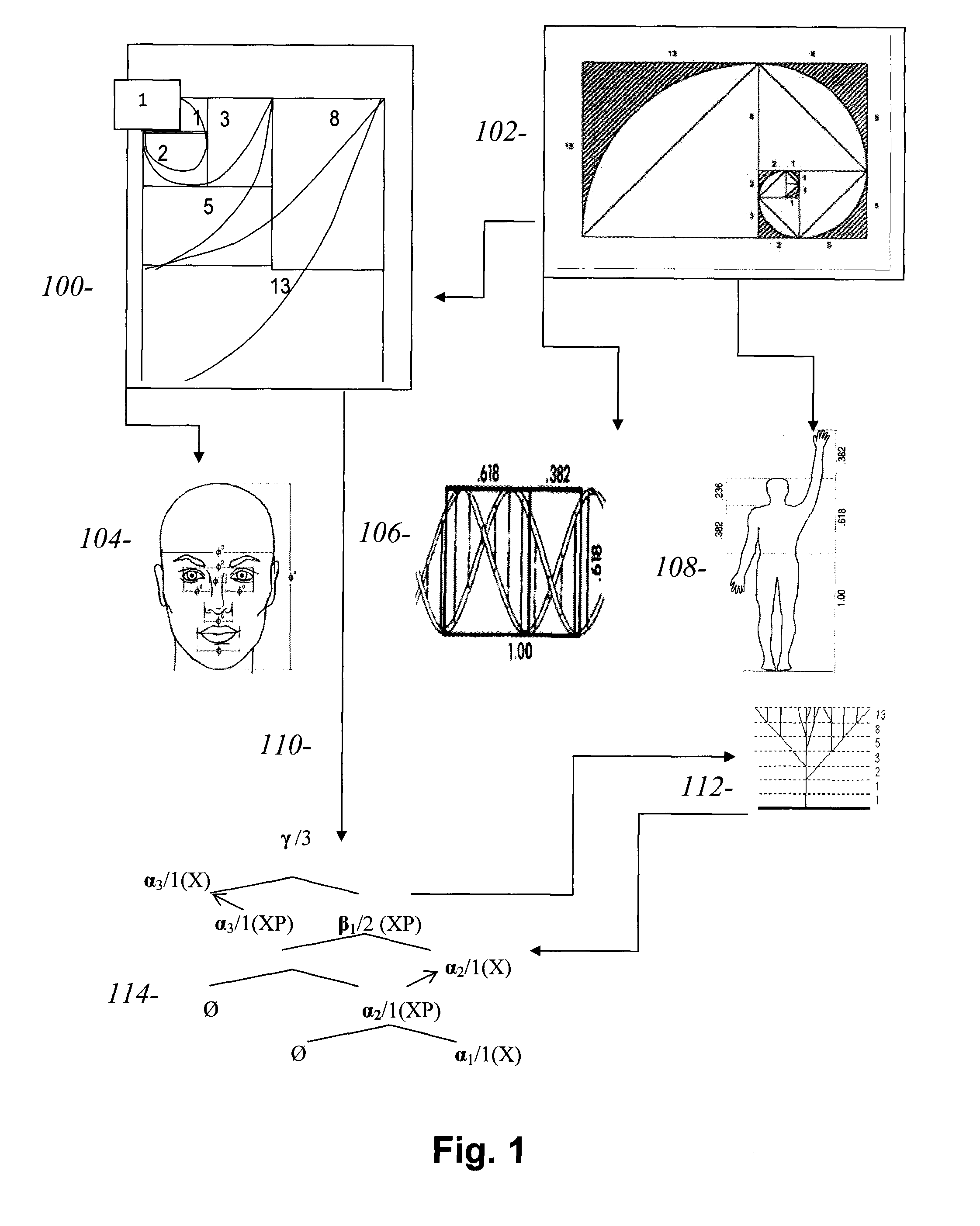

In the present invention, a textual document is syntactically analyzed and knowledge is constructed from a single word or plural words. The knowledge is then marked, from the broken down knowledge (represented by the underscores in FIG. 1) or from a part-of-speech, as a related object (node) or a relation (edge) (represented by ‘n’ or ‘e’ shown in FIG. 1). In other words, in the present invention a textual document is treated as knowledge constructed from a single word or plural words. The knowledge extracted from the textual document is structured to form a knowledge structure (such as a graph structure constituted from nodes and edges). At least one link can be established between each of the knowledge structure elements and a semantically closest concept entry in a hierarchical concept dictionary.

Owner:CELESTAR LEXICO SCI

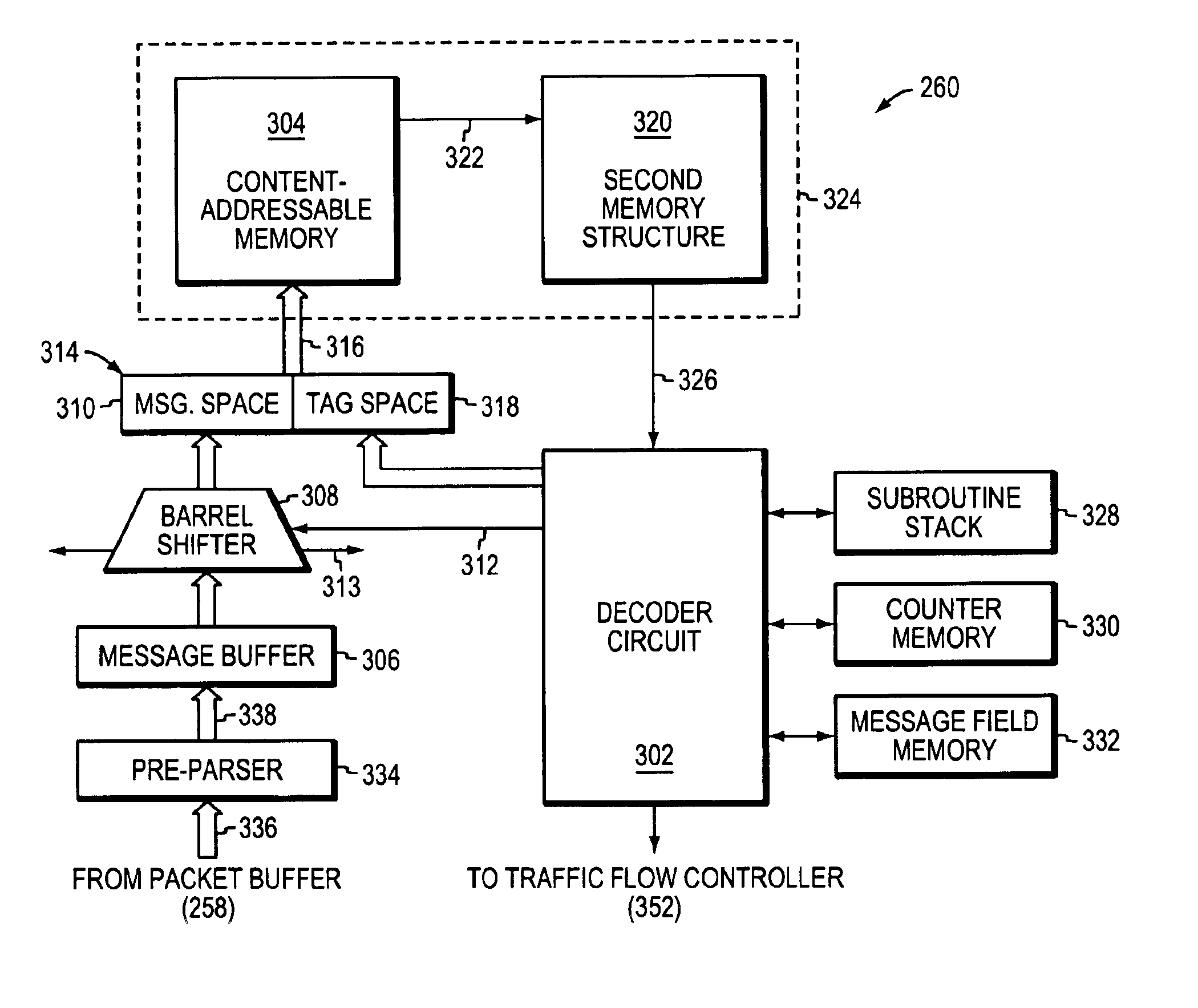

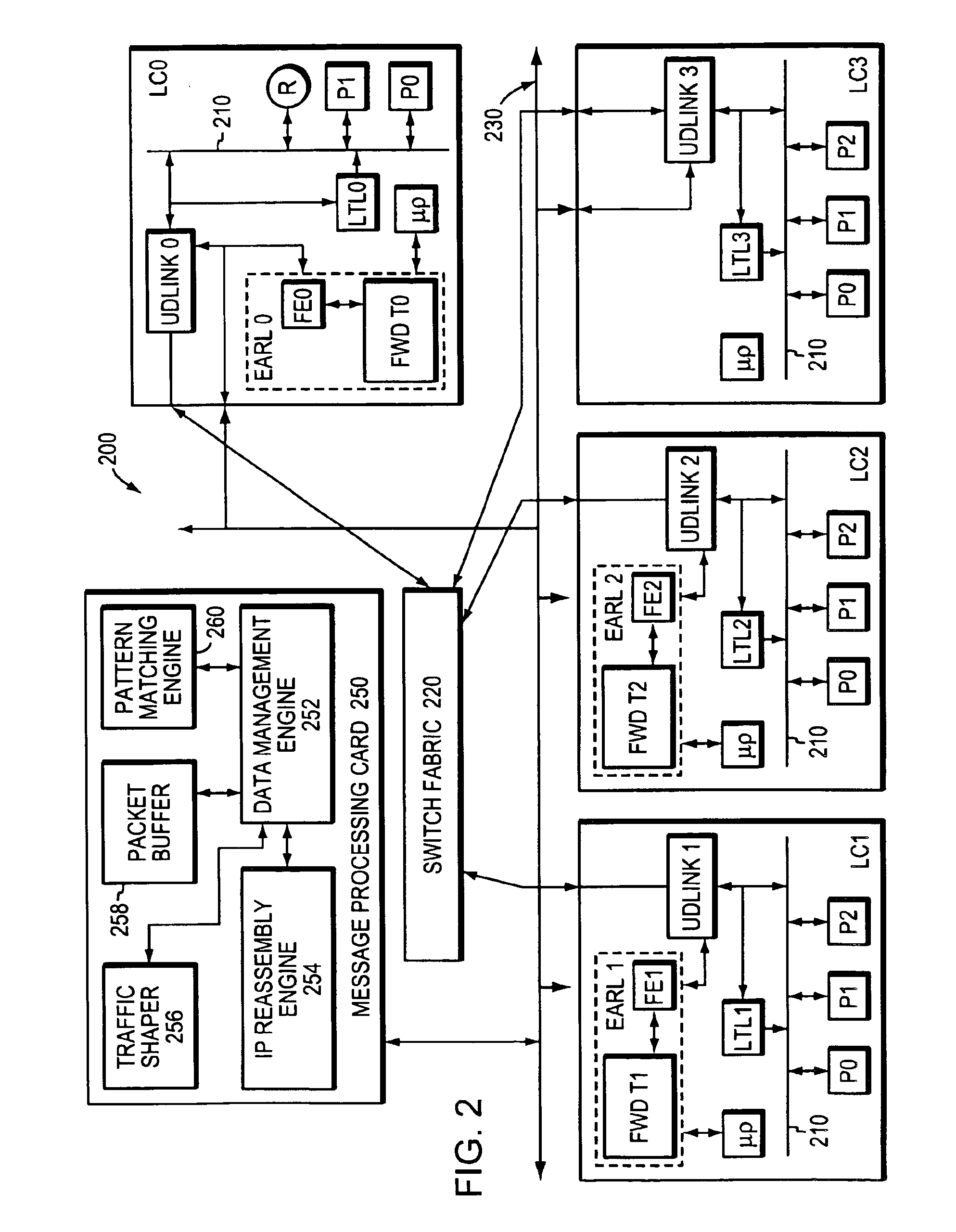

Method and apparatus for high-speed parsing of network messages

InactiveUS6892237B1Efficient analysisIncrease speedMultiple digital computer combinationsData switching networksPattern matchingRandom access memory

A programmable pattern matching engine efficiently parses the contents of network messages for regular expressions and executes pre-defined actions or treatments on those messages that match the regular expressions. The pattern matching engine is preferably a logic circuit designed to perform its pattern matching and execution functions at high speed, e.g., at multi-gigabit per second rates. It includes, among other things, a message buffer for storing the message being evaluated, a decoder circuit for decoding and executing corresponding actions or treatments, and one or more content-addressable memories (CAMs) that are programmed to store the regular expressions used to search the message. The CAM may be associated with a second memory device, such as a random access memory (RAM), as necessary, that is programmed to contain the respective actions or treatments to be applied to messages matching the corresponding CAM entries. The RAM provides its output to the decoder circuit, which, in response, decodes and executes the specified action or treatment.

Owner:CISCO TECH INC

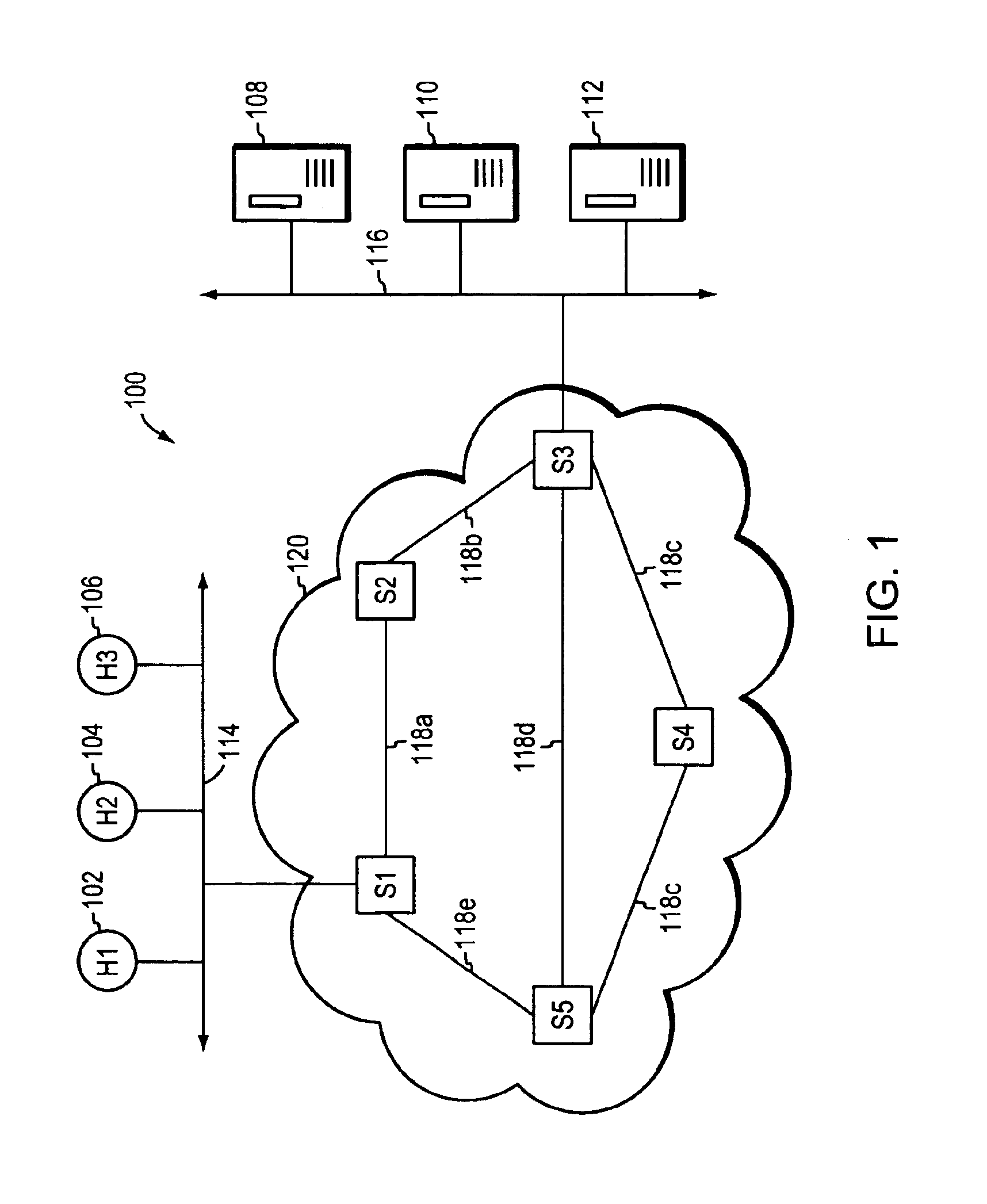

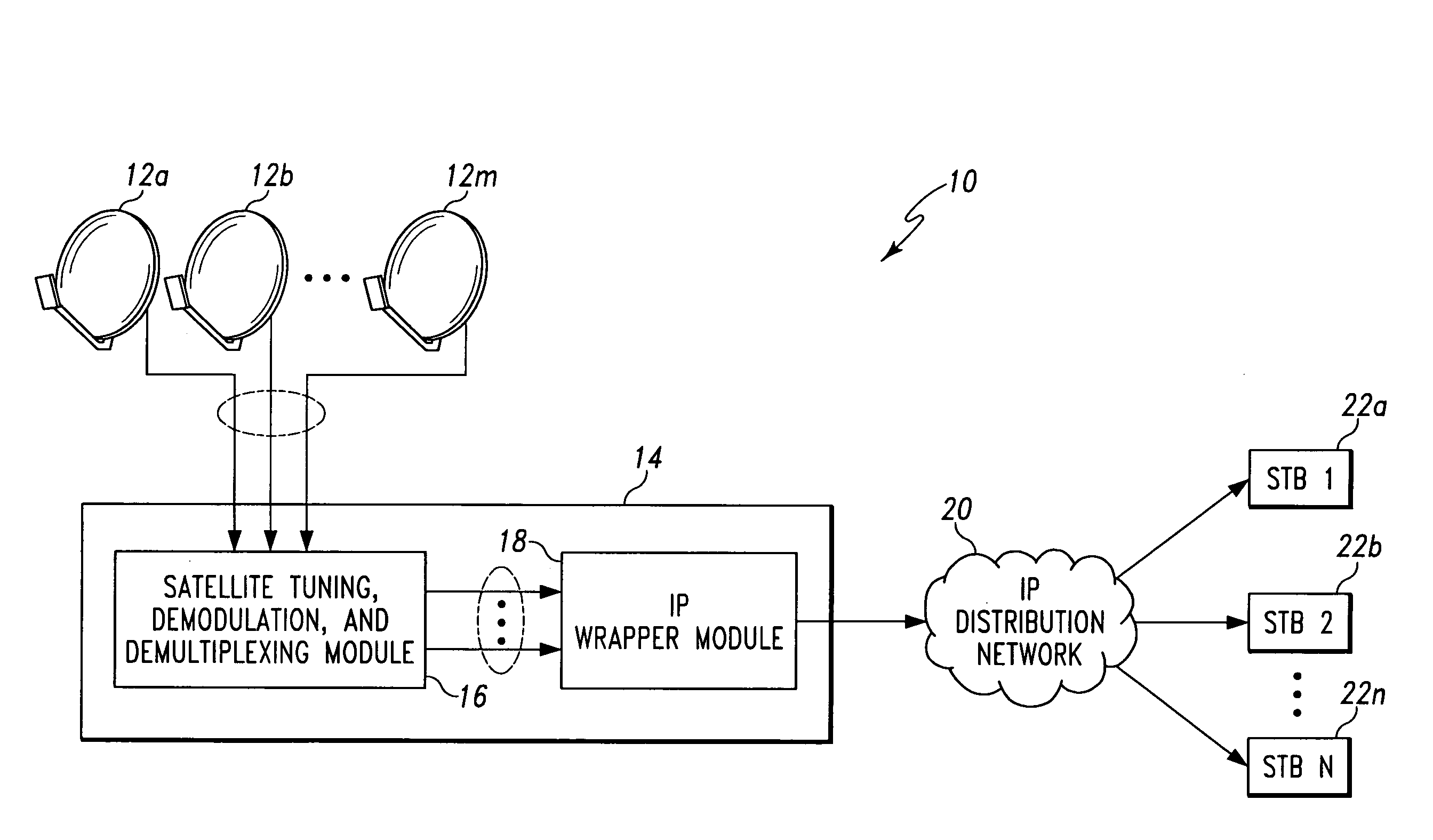

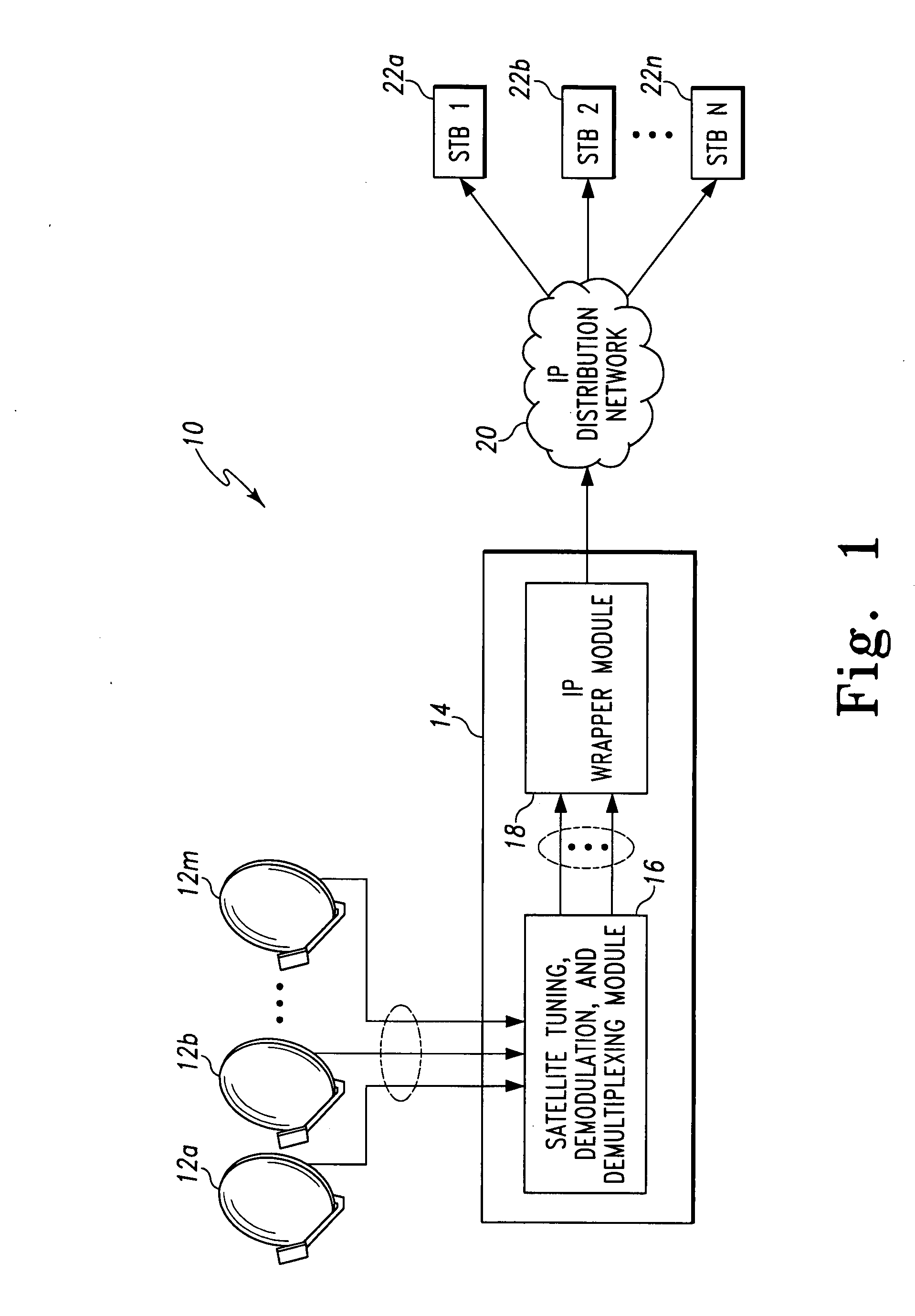

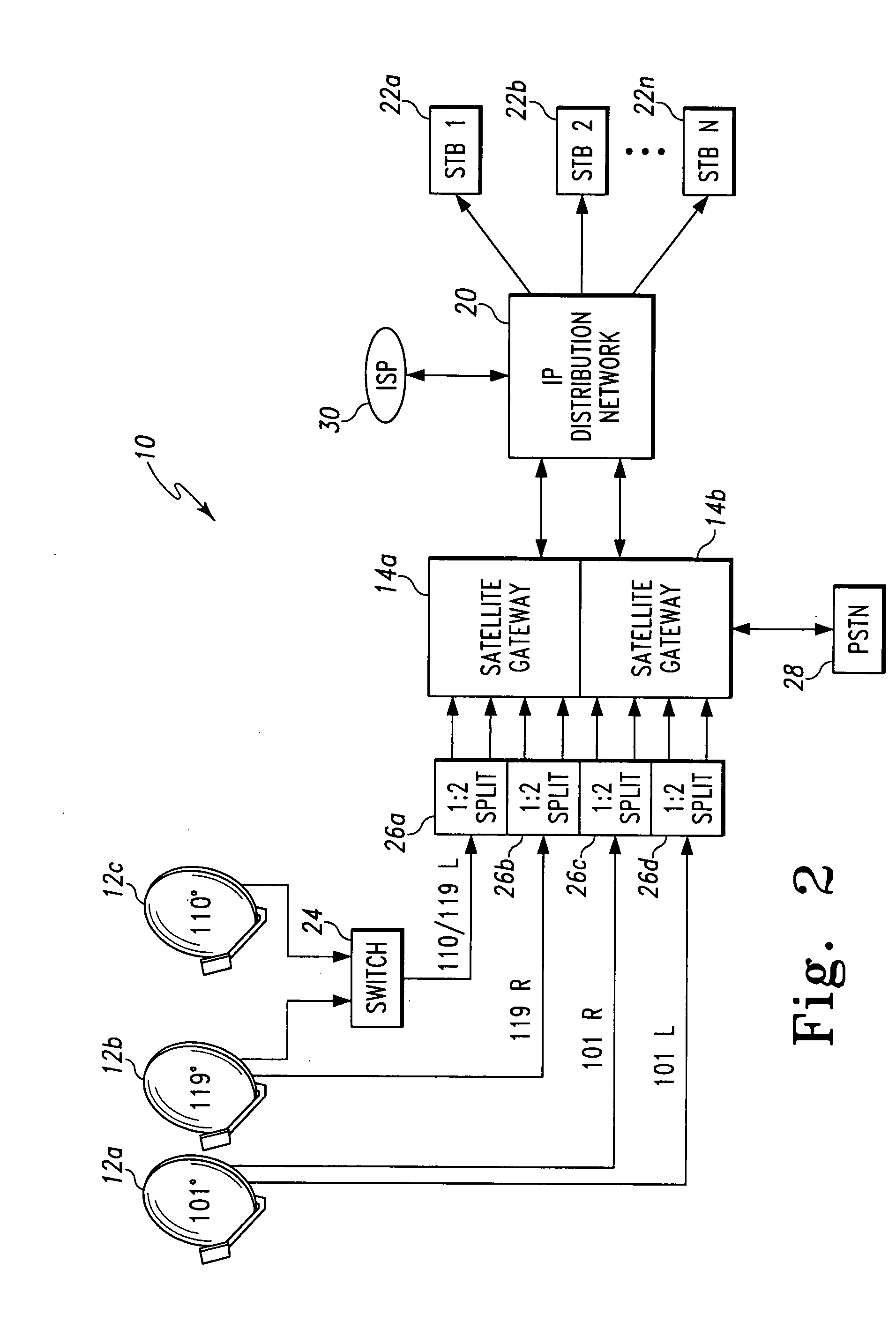

System and method for inserting sync bytes into transport packets

ActiveUS20090007190A1Satellite broadcast receivingBroadcast specific applicationsByteComputer science

The disclosed embodiments relate to a system and method for inserting sync bytes into a video transport stream. More specifically, there is provided a method comprising determining a parsing procedure supported by a first set top box, appending a first transport packet to comply with the parsing procedure of the first set top box, and transmitting the first transport packet to the first set top box.

Owner:INTERDIGITAL CE PATENT HLDG

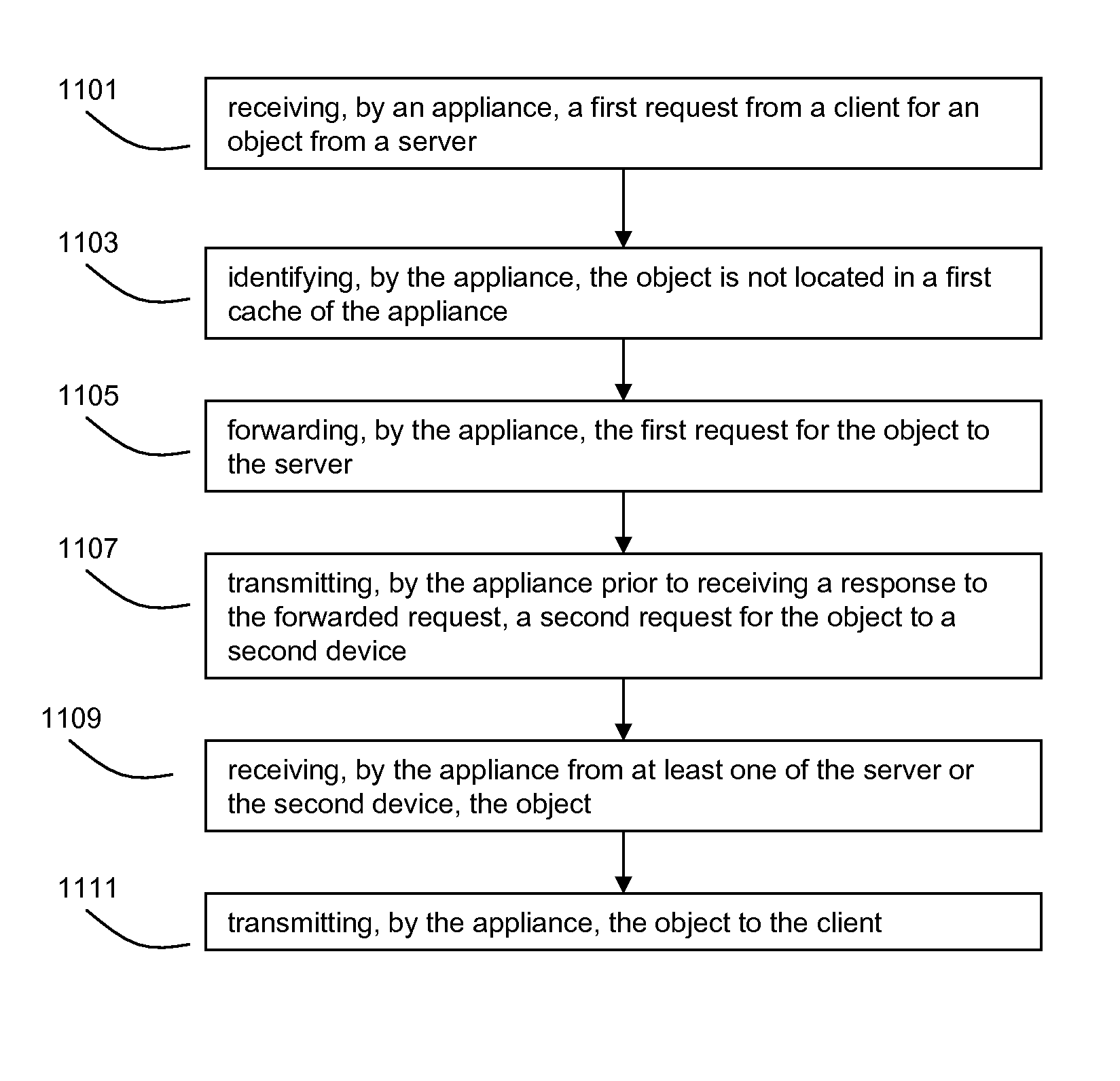

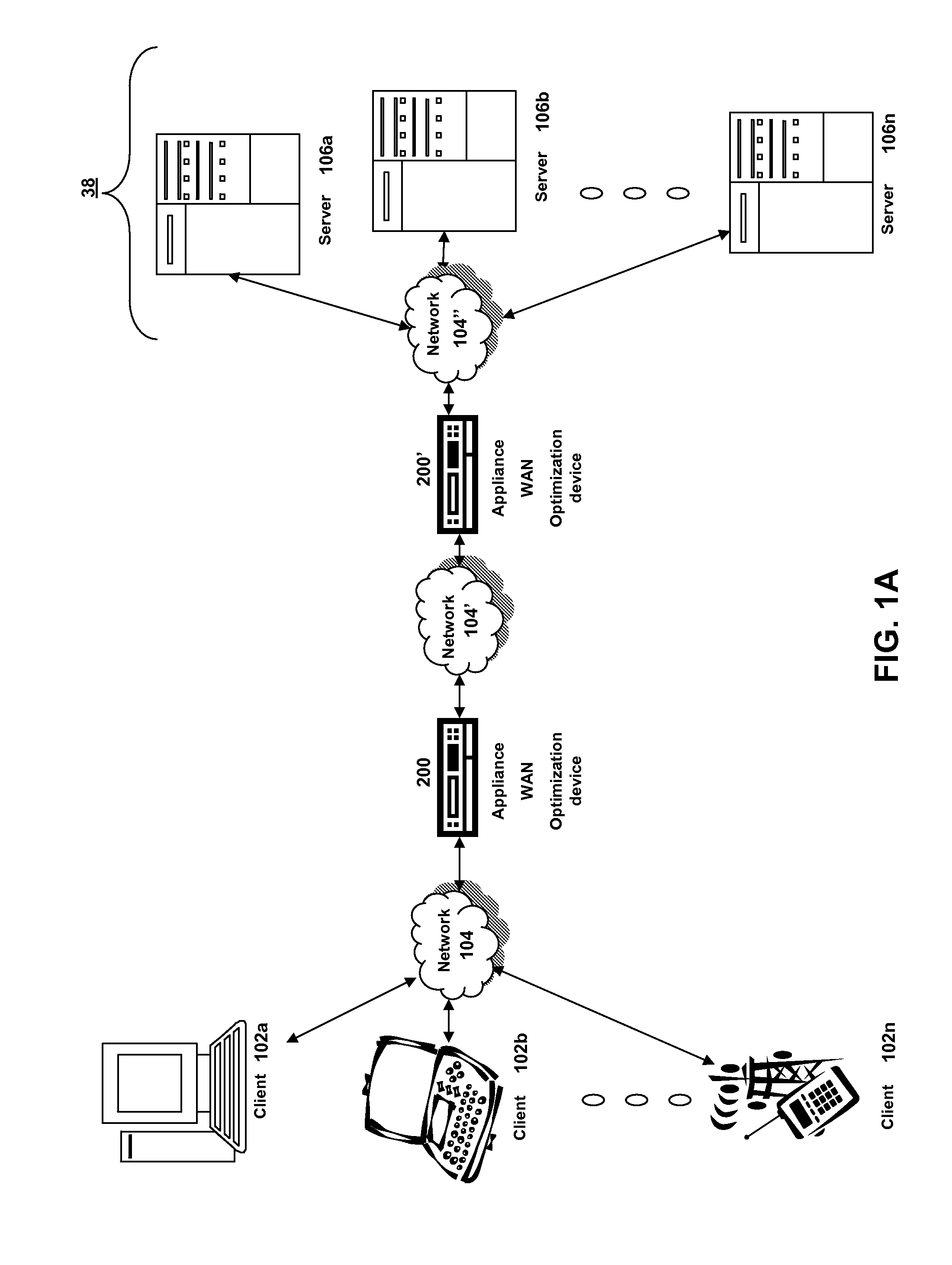

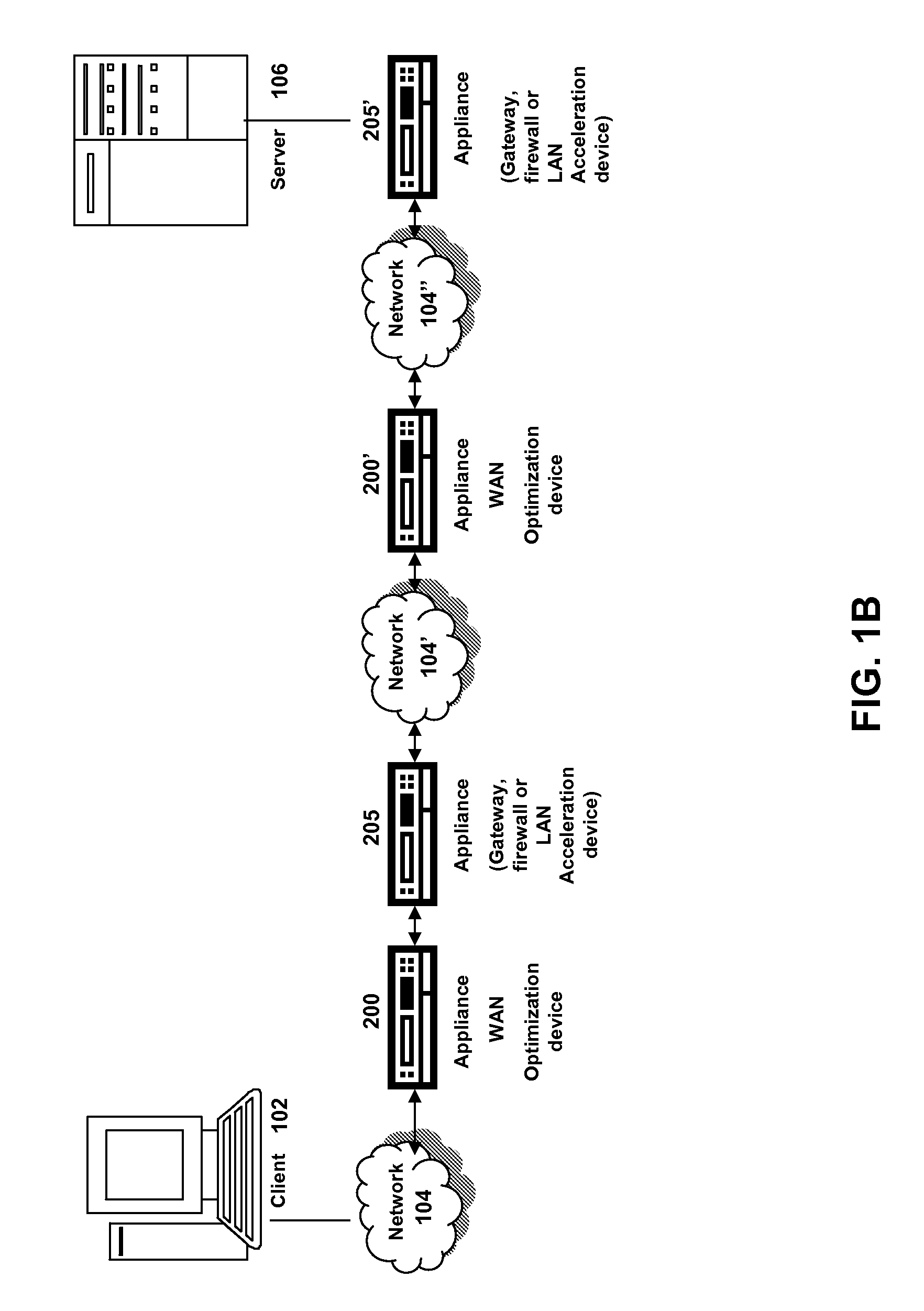

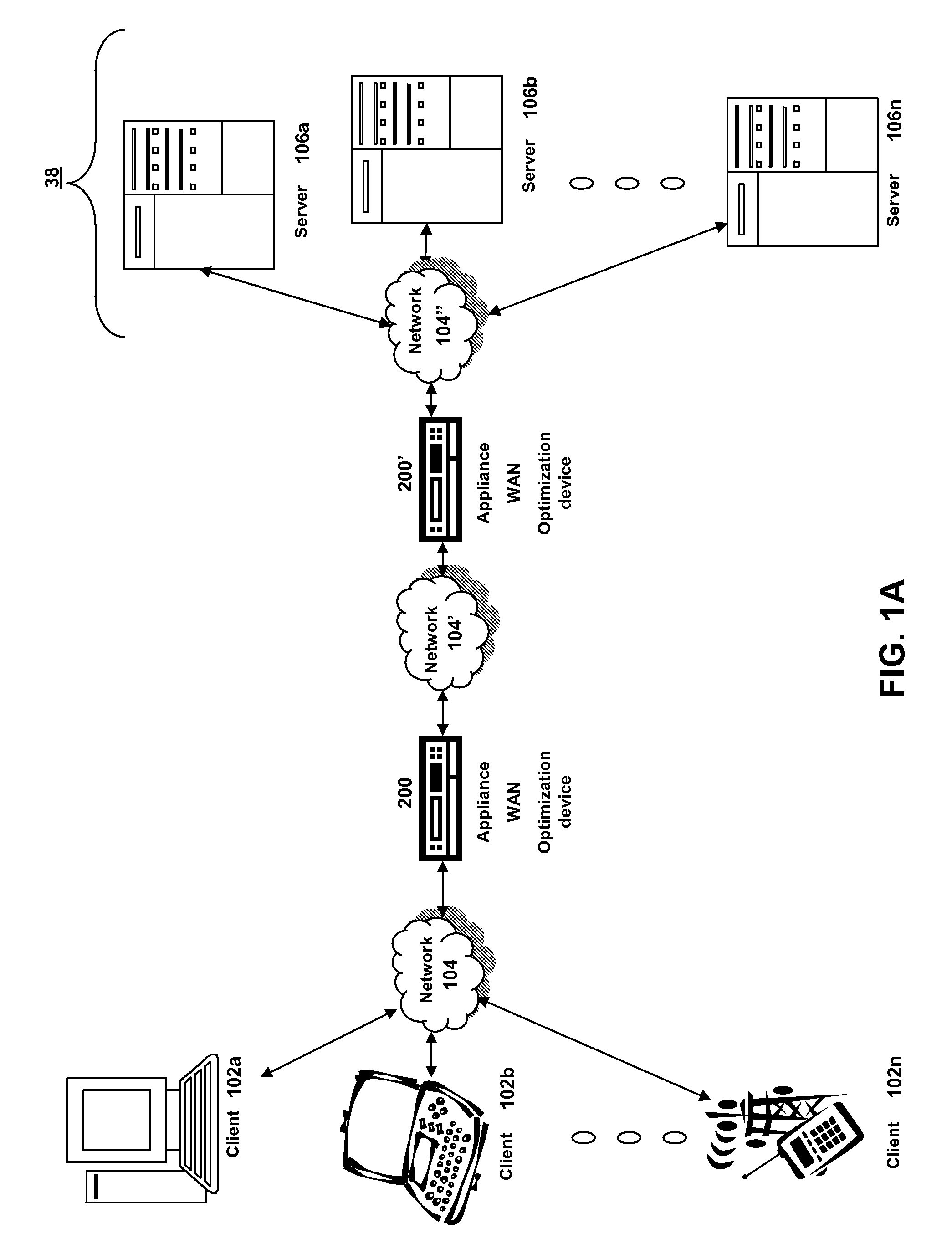

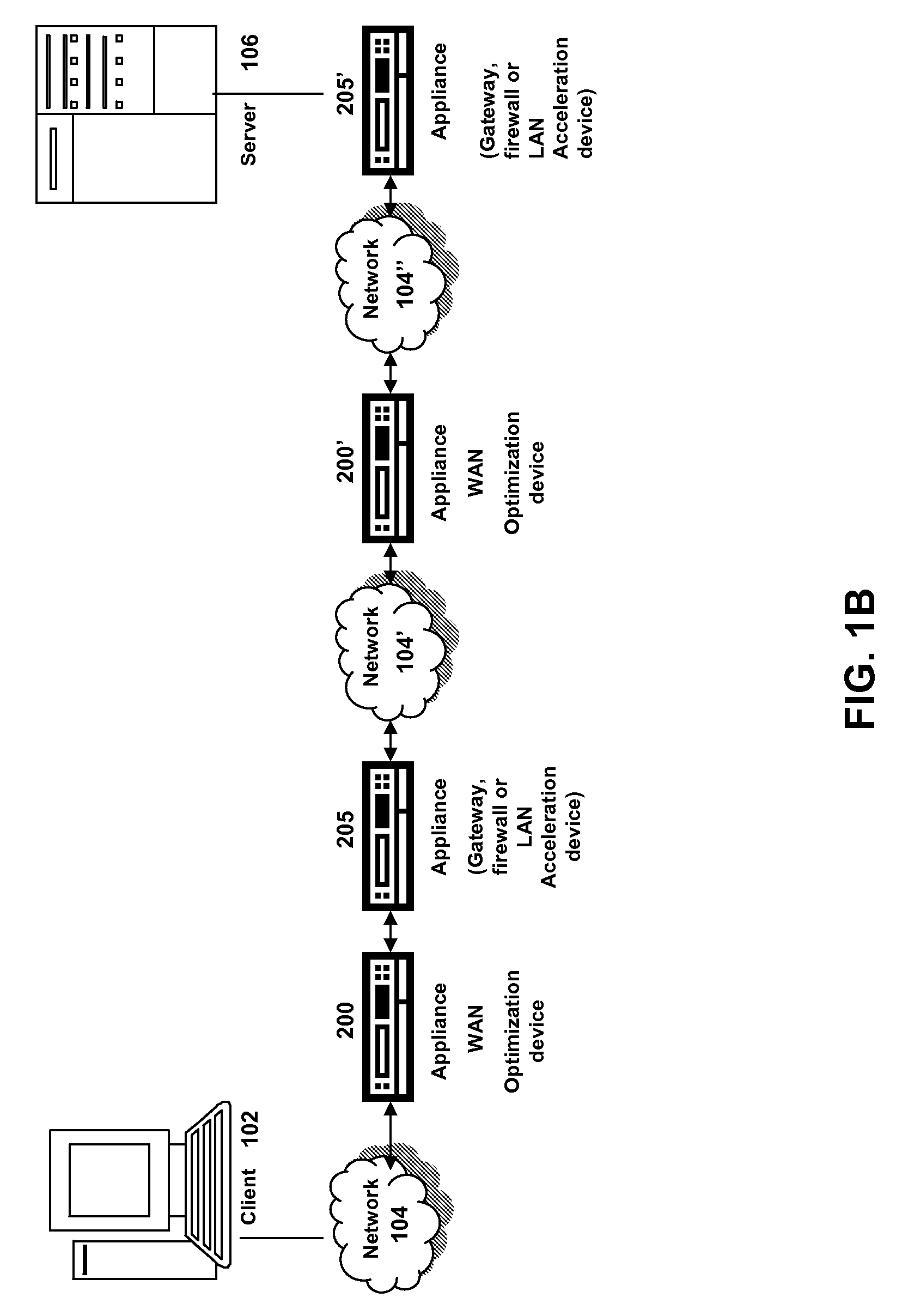

Systems and methods for providing dynamic ad hoc proxy-cache hierarchies

ActiveUS7865585B2Improve compression efficiently and speedIncrease the lengthMultiple digital computer combinationsTransmissionApplication specificDistributed computing

Systems and methods of storing previously transmitted data and using it to reduce bandwidth usage and accelerate future communications are described. By using algorithms to identify long compression history matches, a network device may improve compression efficiently and speed. A network device may also use application specific parsing to improve the length and number of compression history matches. Further, by sharing compression histories, compression history indexes and caches across multiple devices, devices can utilize data previously transmitted to other devices to compress network traffic. Any combination of the systems and methods may be used to efficiently find long matches to stored data, synchronize the storage of previously sent data, and share previously sent data among one or more other devices.

Owner:CITRIX SYST INC

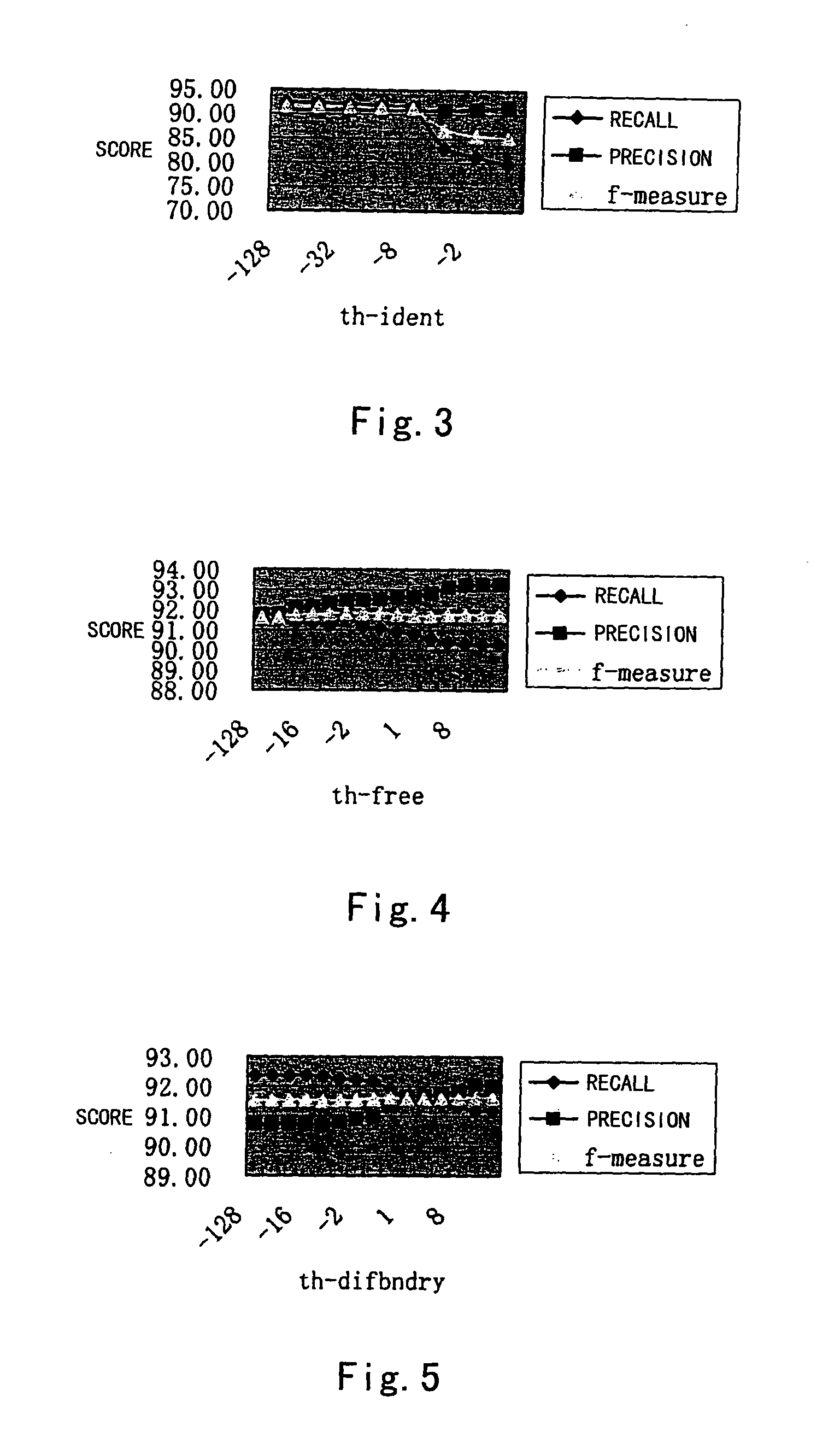

Method and apparatus for named entity recognition in natural language

ActiveUS20090326923A1Improve performanceAvoid influenceNatural language translationSemantic analysisOne-class classificationPattern recognition

The present invention provides a method for recognizing a named entity included in natural language, comprising the steps of: performing gradual parsing model training with the natural language to obtain a classification model; performing gradual parsing and recognition according to the obtained classification model to obtain information on positions and types of candidate named entities; performing a refusal recognition process for the candidate named entities; and generating a candidate named entity lattice from the refusal-recognition-processed candidate named entities, and searching for a optimal path. The present invention uses a one-class classifier to score or evaluate these results to obtain the most reliable beginning and end borders of the named entities on the basis of the forward and backward parsing and recognizing results obtained only by using the local features.

Owner:PANASONIC CORP

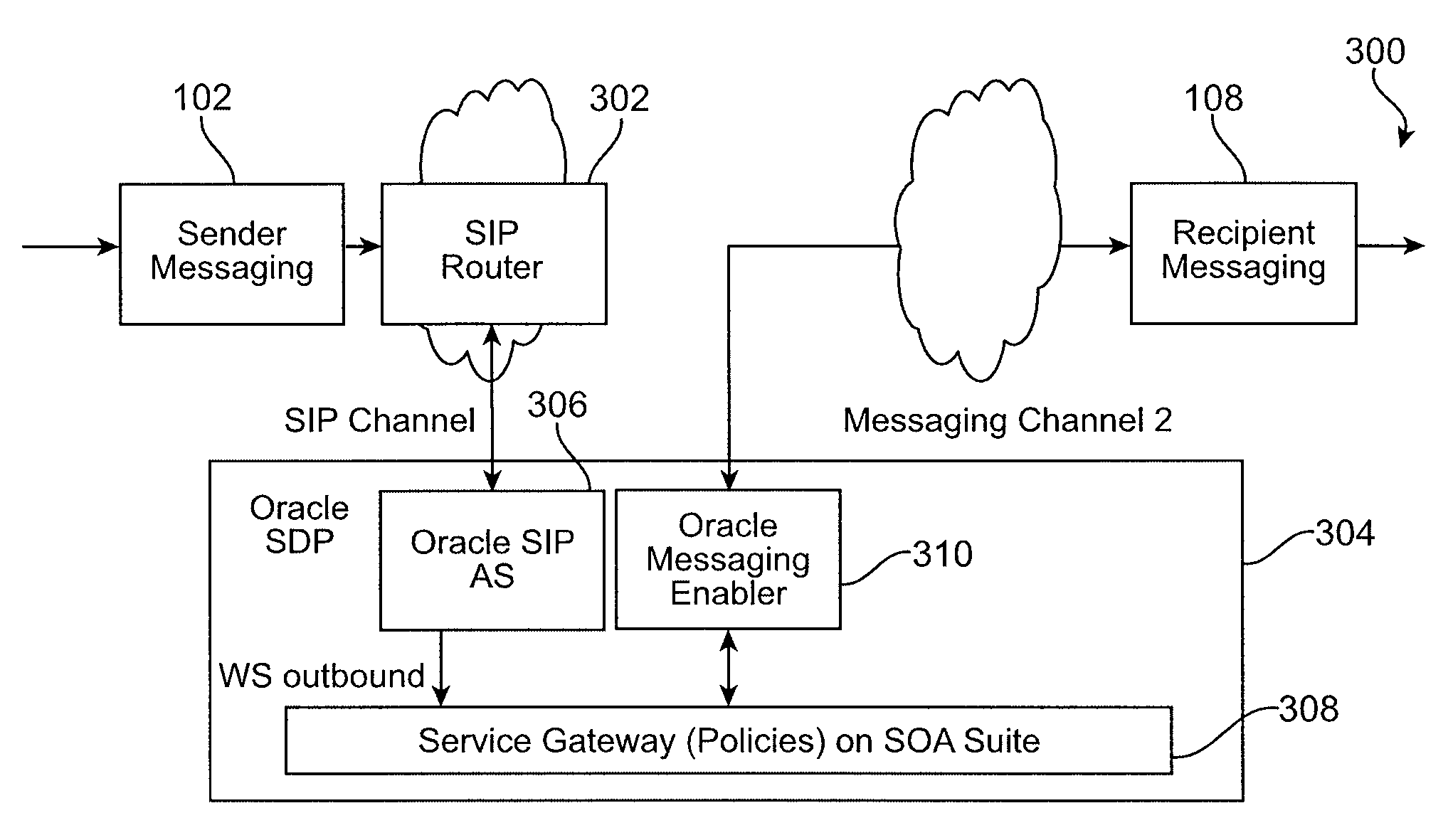

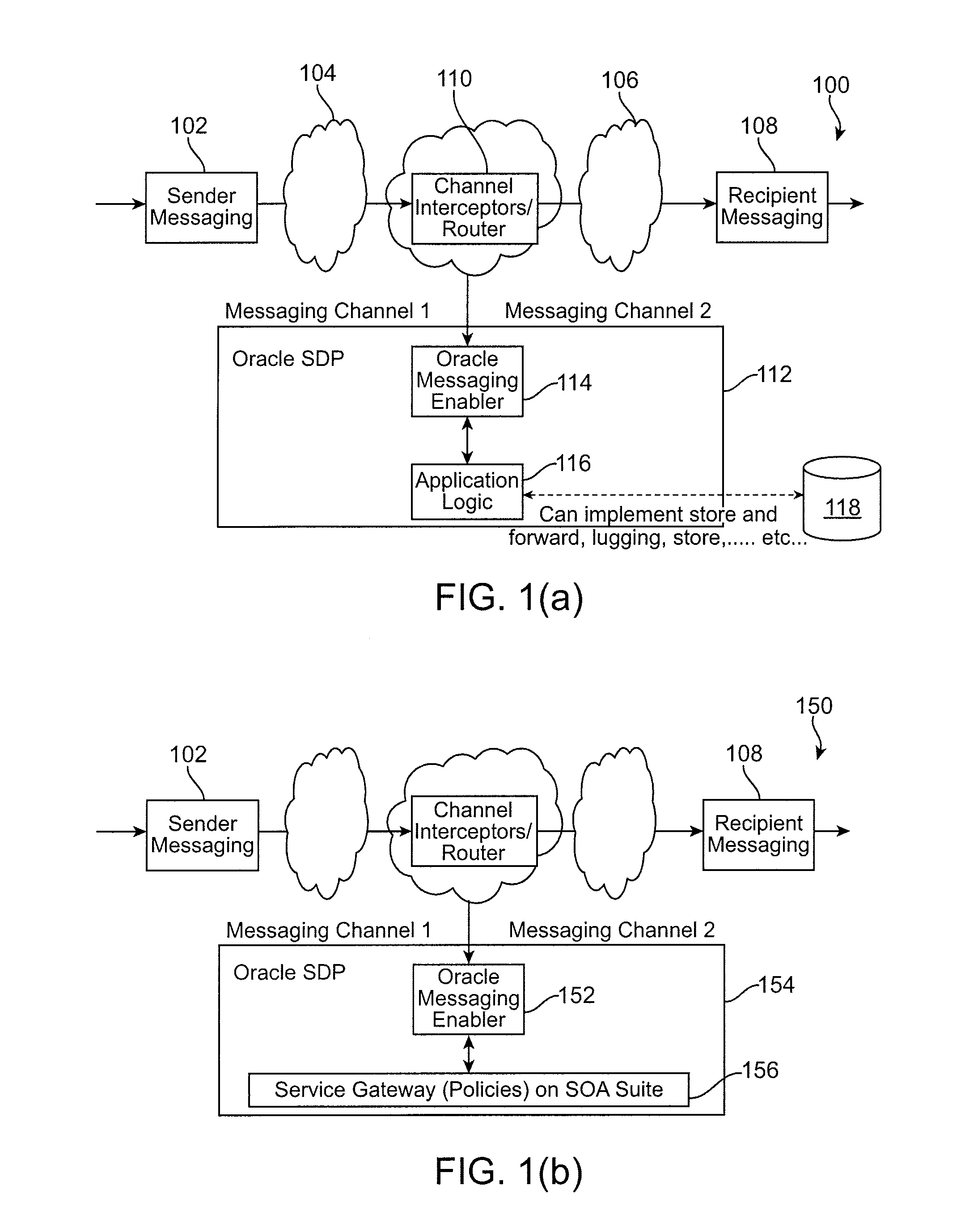

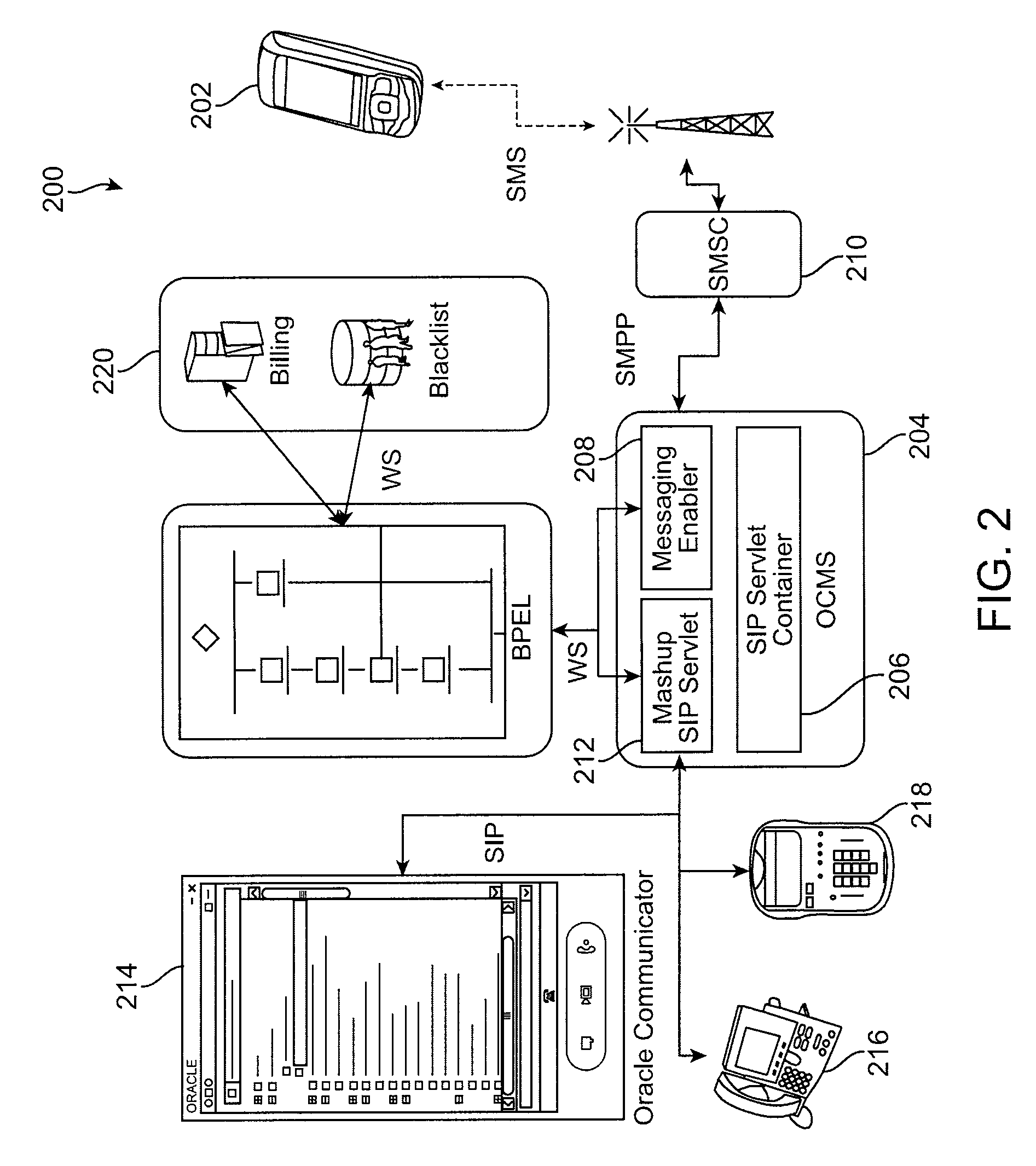

Intelligent message processing

ActiveUS20090125595A1Overcome deficienciesIntelligent processingTelephonic communicationMultiple digital computer combinationsComputer hardwareWeb service

Intelligent message processing is provided for person to person (P2P) messaging by intercepting the message and processing the message before directing the message to the recipient. The messaging system then acts as a person to application (P2A) and application to person (A2P) system, wherein any P2P message can be intercepted and processed as necessary. Such functionality allows any desired processing of the message, such as to allow for transformation, charging, content filtering, screening, parsing, and any other such processing. Further, such an approach allows the message to be received from the sender and directed to the recipient on different channels. A messaging enabler allows the message to be processed using application logic and / or Web services, for example.

Owner:ORACLE INT CORP

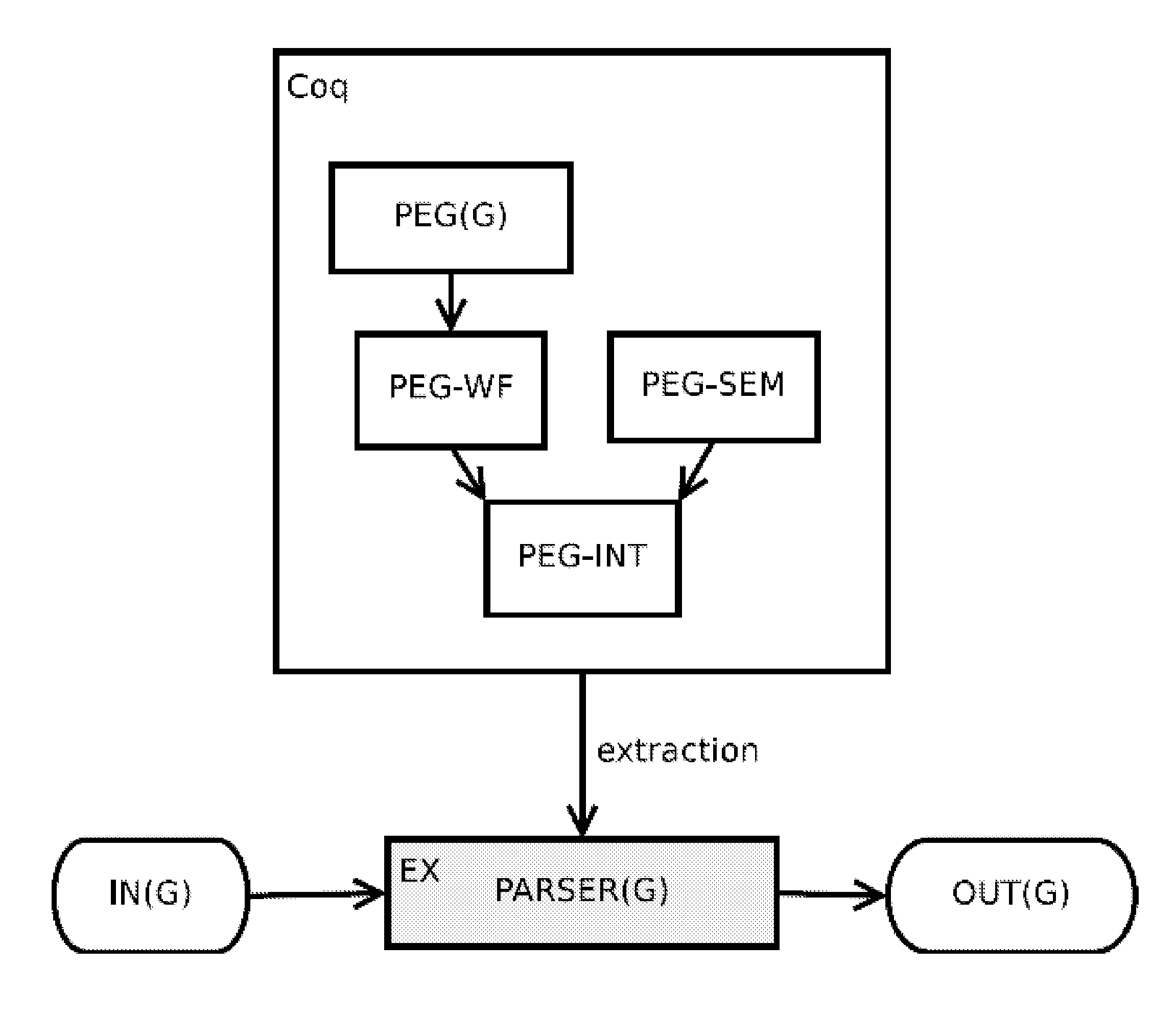

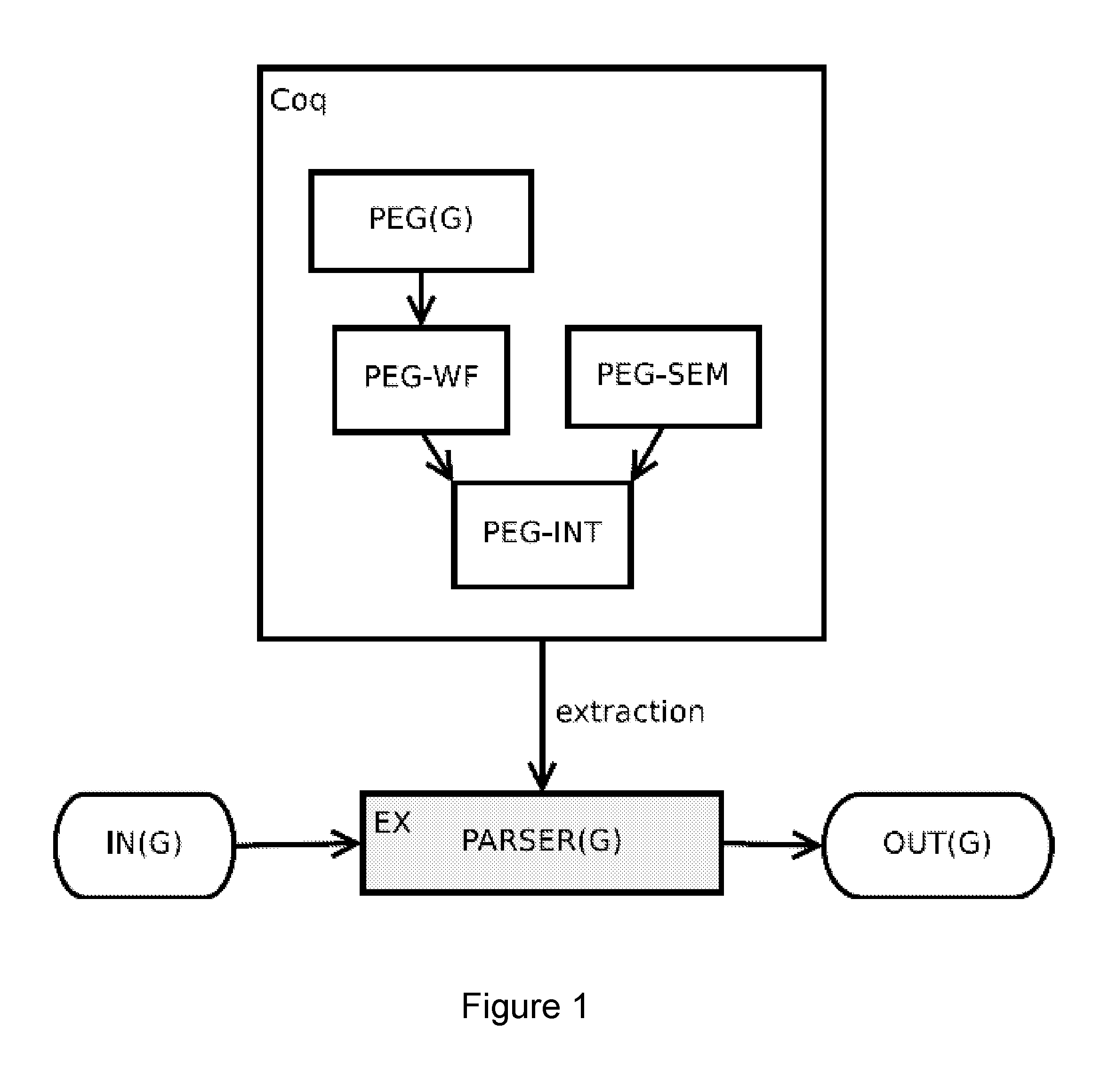

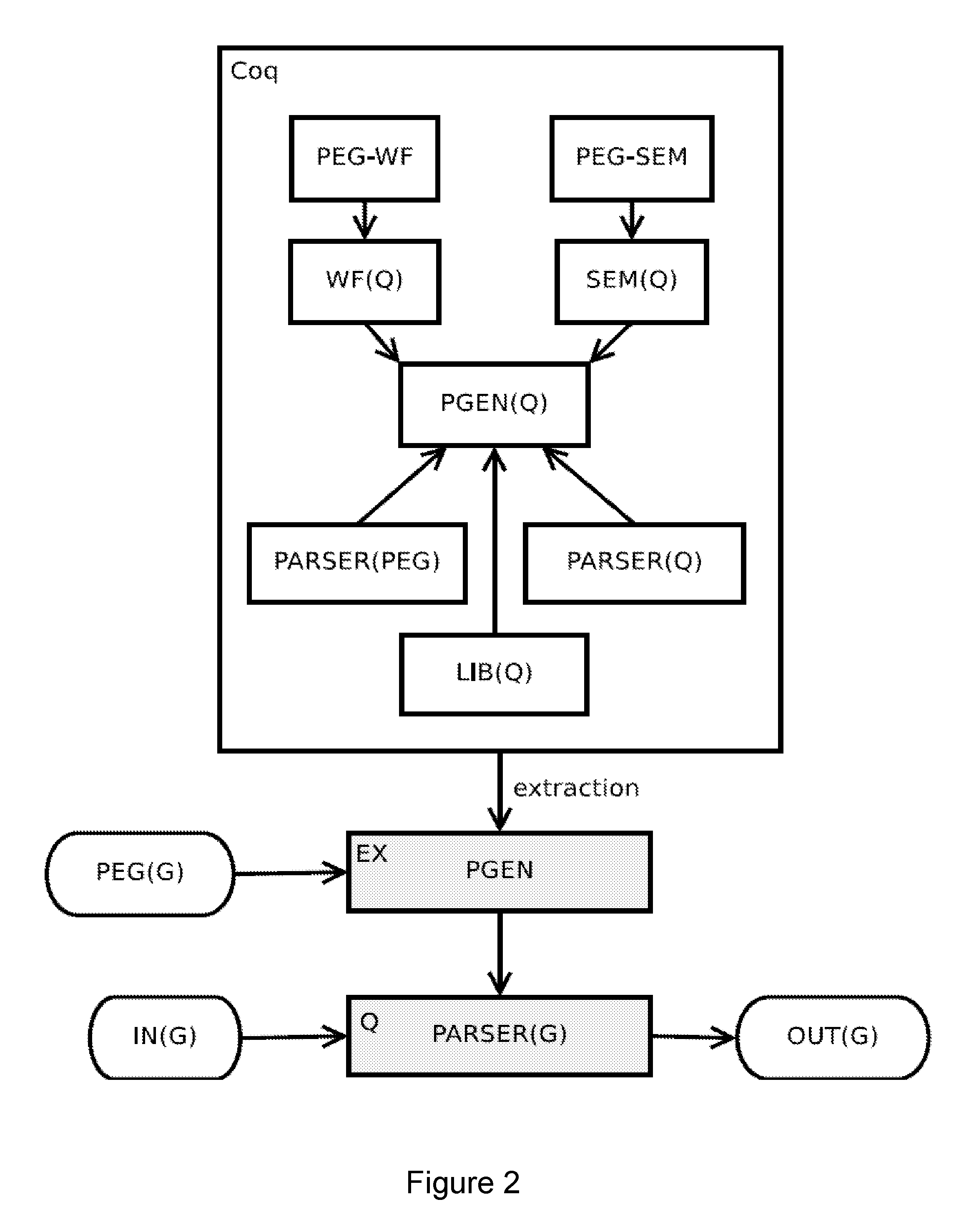

System and method for creating a parser generator and associated computer program

InactiveUS20120191446A1Quality improvementImprove securitySpecial data processing applicationsCompiler constructionComputer moduleParsing

A system is provided for building a parser generator. The system includes a grammar input module for inputting in the parser generator a grammar expressed in a given formalism. A checking module formally verifies that a given grammar belongs to a predetermined class of grammars for which a translation to a correct, terminating parser is feasible. A checking module formally verifies that a grammar expressed in the formalism is well-formed. A semantic action module defines a parsing result depending on semantic actions embedded in the grammar. The semantic action module ensures in a formal way that all semantic actions of the grammar are terminating semantic actions. A formal module generates a parser with total correctness guarantees, using the modules to verify that the grammar is well-formed, belongs to a certain class of feasible, terminating grammars and all its semantic actions are terminating.

Owner:PROVICIEL MLSTATE

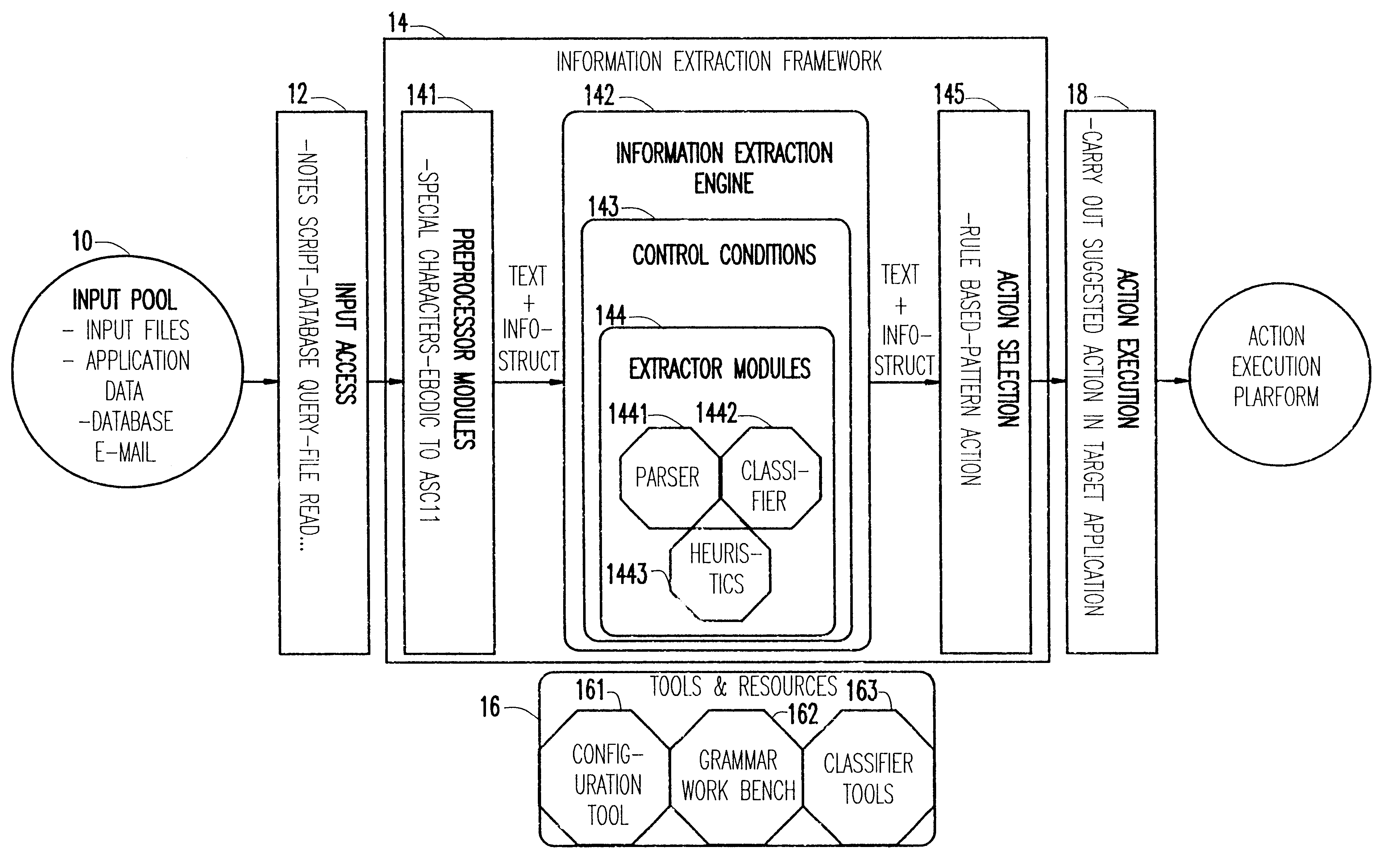

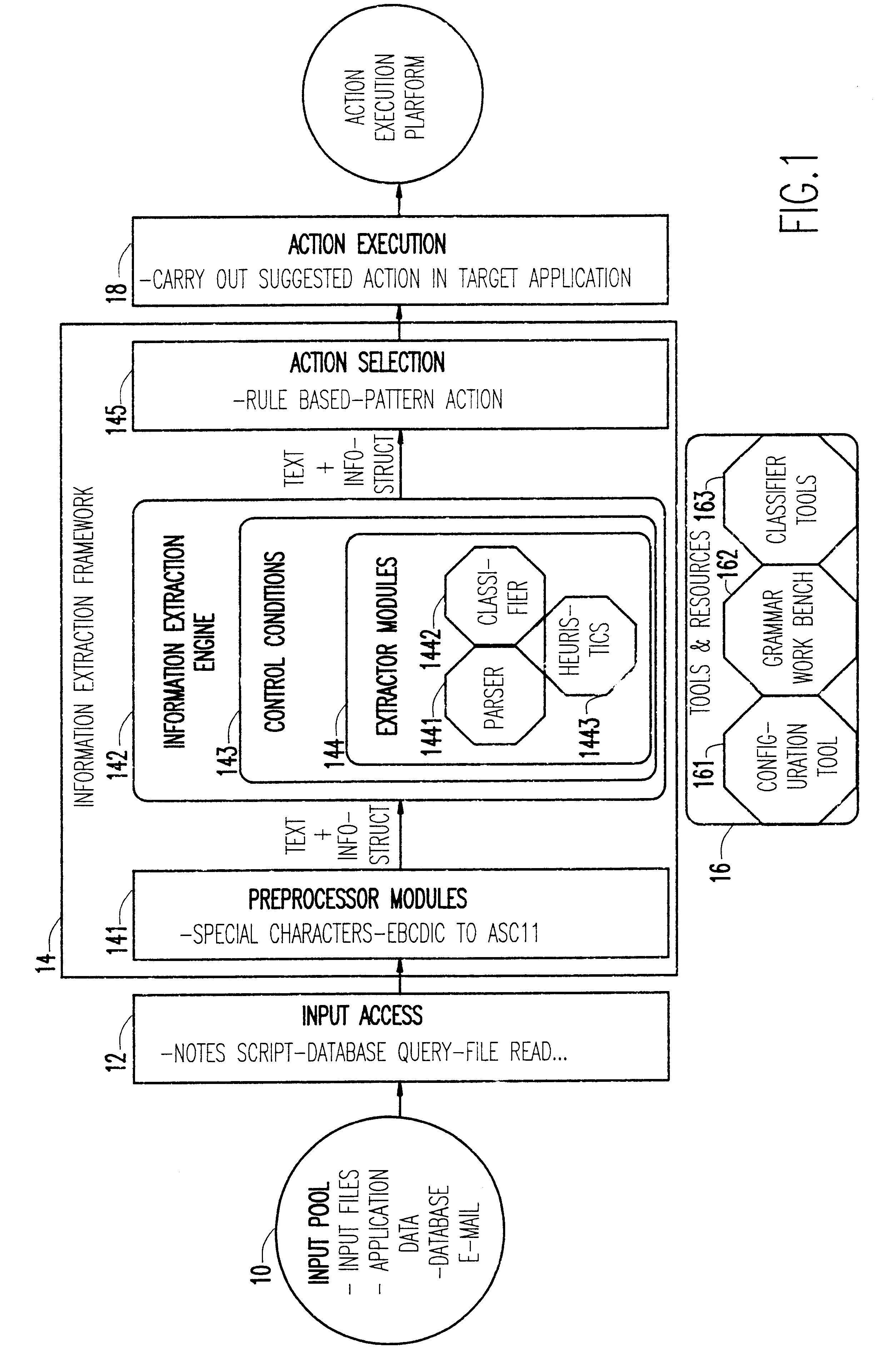

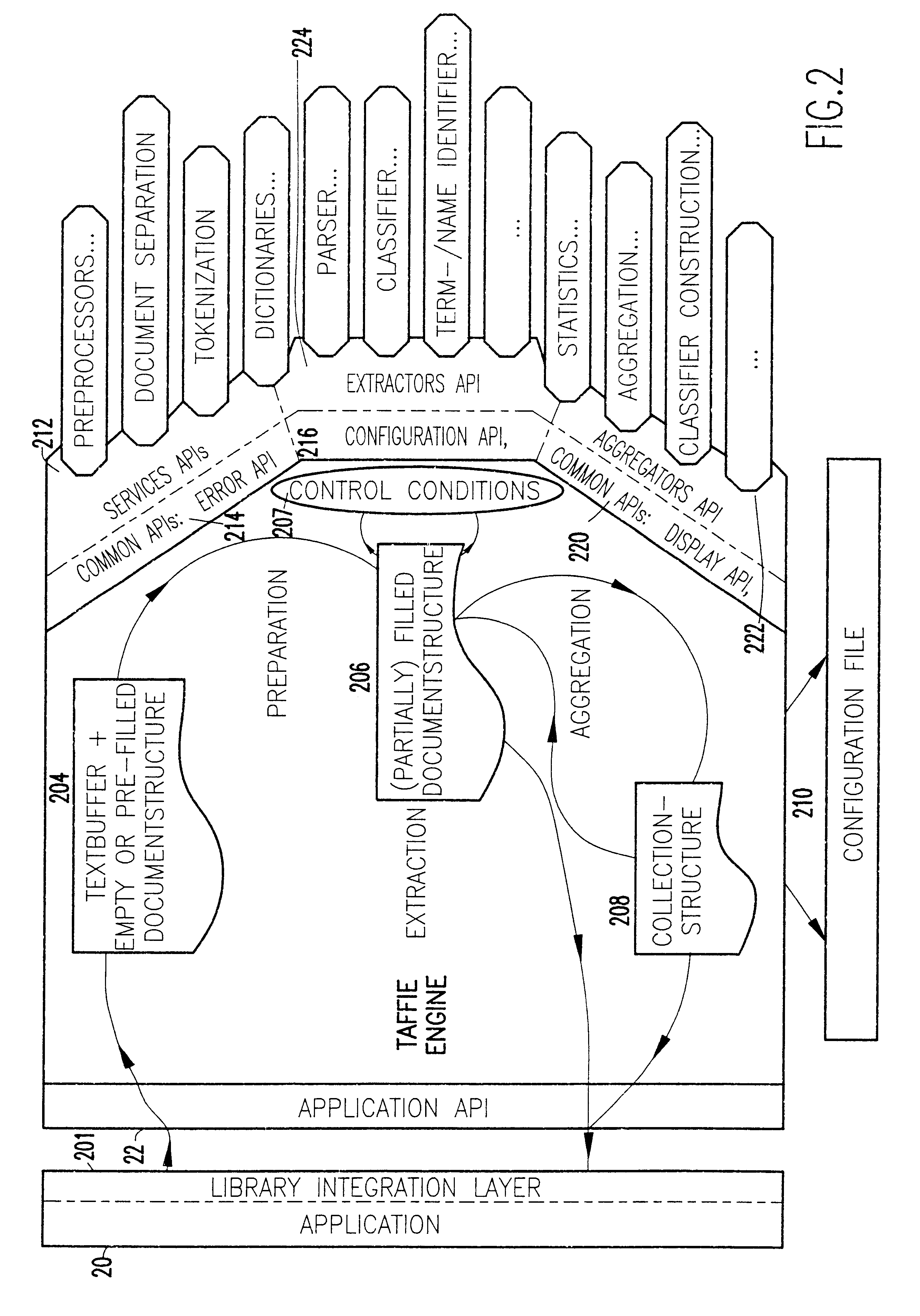

Architecture of a framework for information extraction from natural language documents

InactiveUS6553385B2Data processing applicationsNatural language data processingDocumentation procedureDocument preparation

A framework for information extraction from natural language documents is application independent and provides a high degree of reusability. The framework integrates different Natural Language / Machine Learning techniques, such as parsing and classification. The architecture of the framework is integrated in an easy to use access layer. The framework performs general information extraction, classification / categorization of natural language documents, automated electronic data transmission (e.g., E-mail and facsimile) processing and routing, and plain parsing. Inside the framework, requests for information extraction are passed to the actual extractors. The framework can handle both pre- and post processing of the application data, control of the extractors, enrich the information extracted by the extractors. The framework can also suggest necessary actions the application should take on the data. To achieve the goal of easy integration and extension, the framework provides an integration (outside) application program interface (API) and an extractor (inside) API.

Owner:INT BUSINESS MASCH CORP

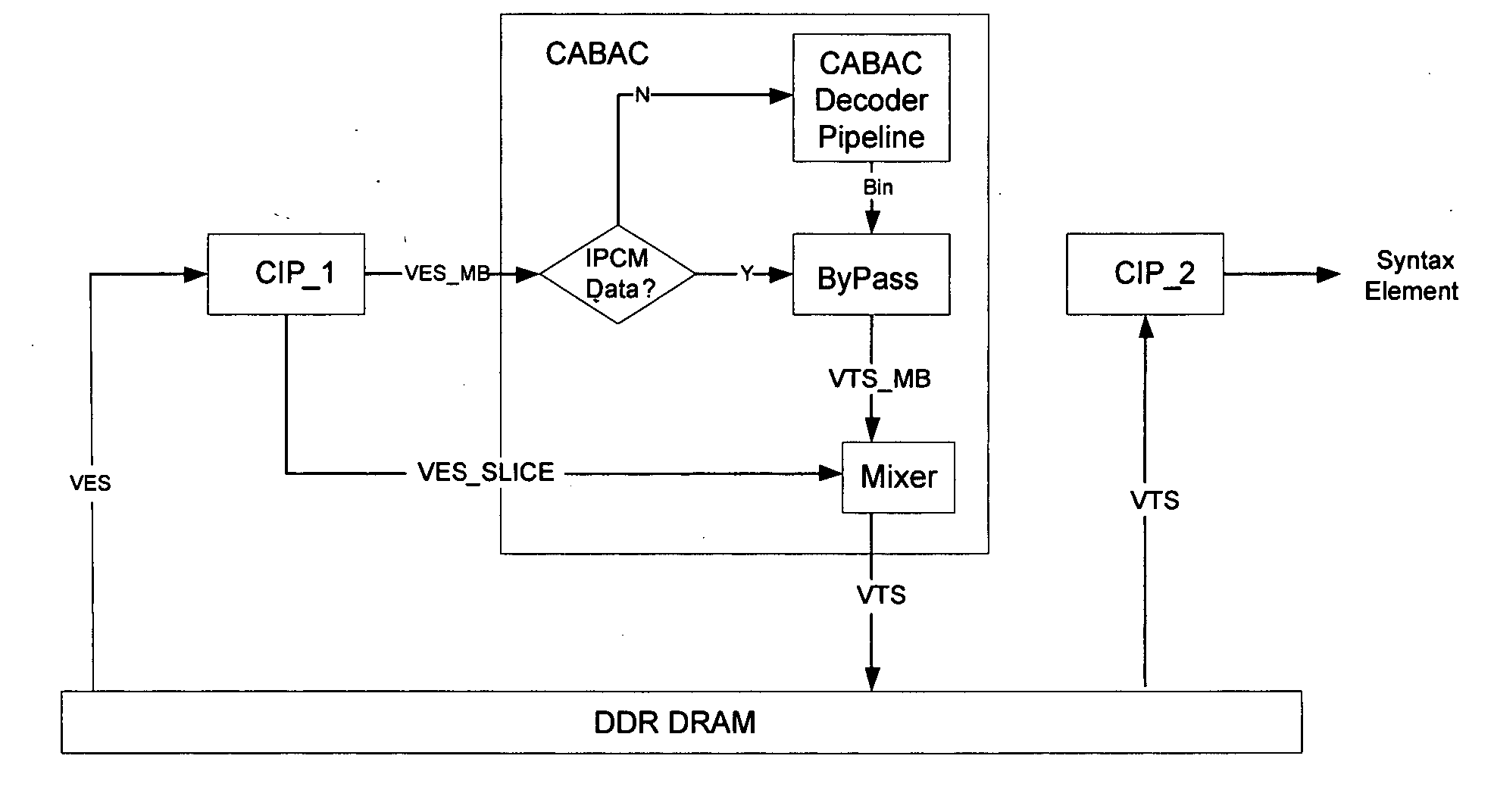

Two pass architecture for H.264 CABAC decoding process

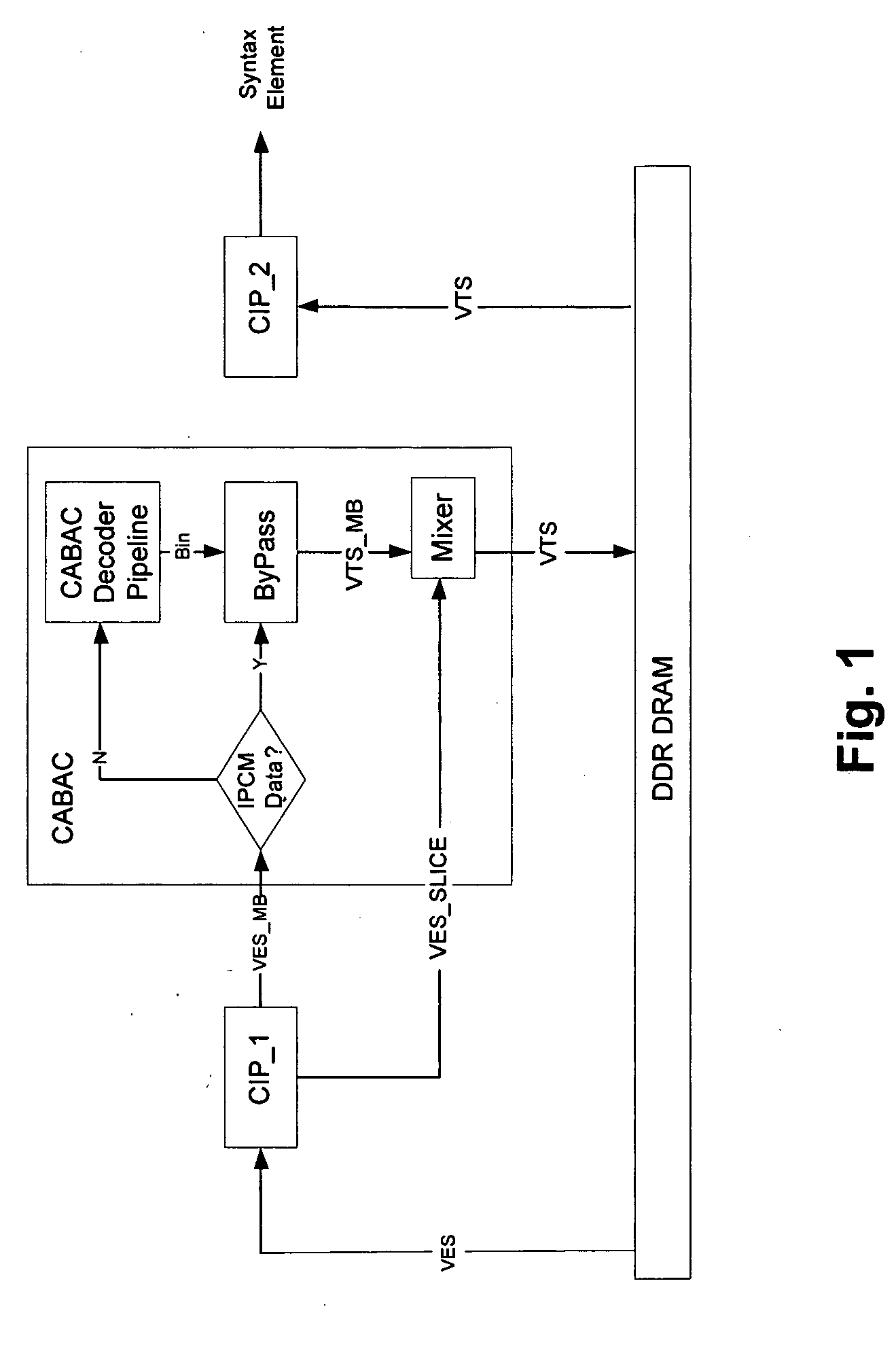

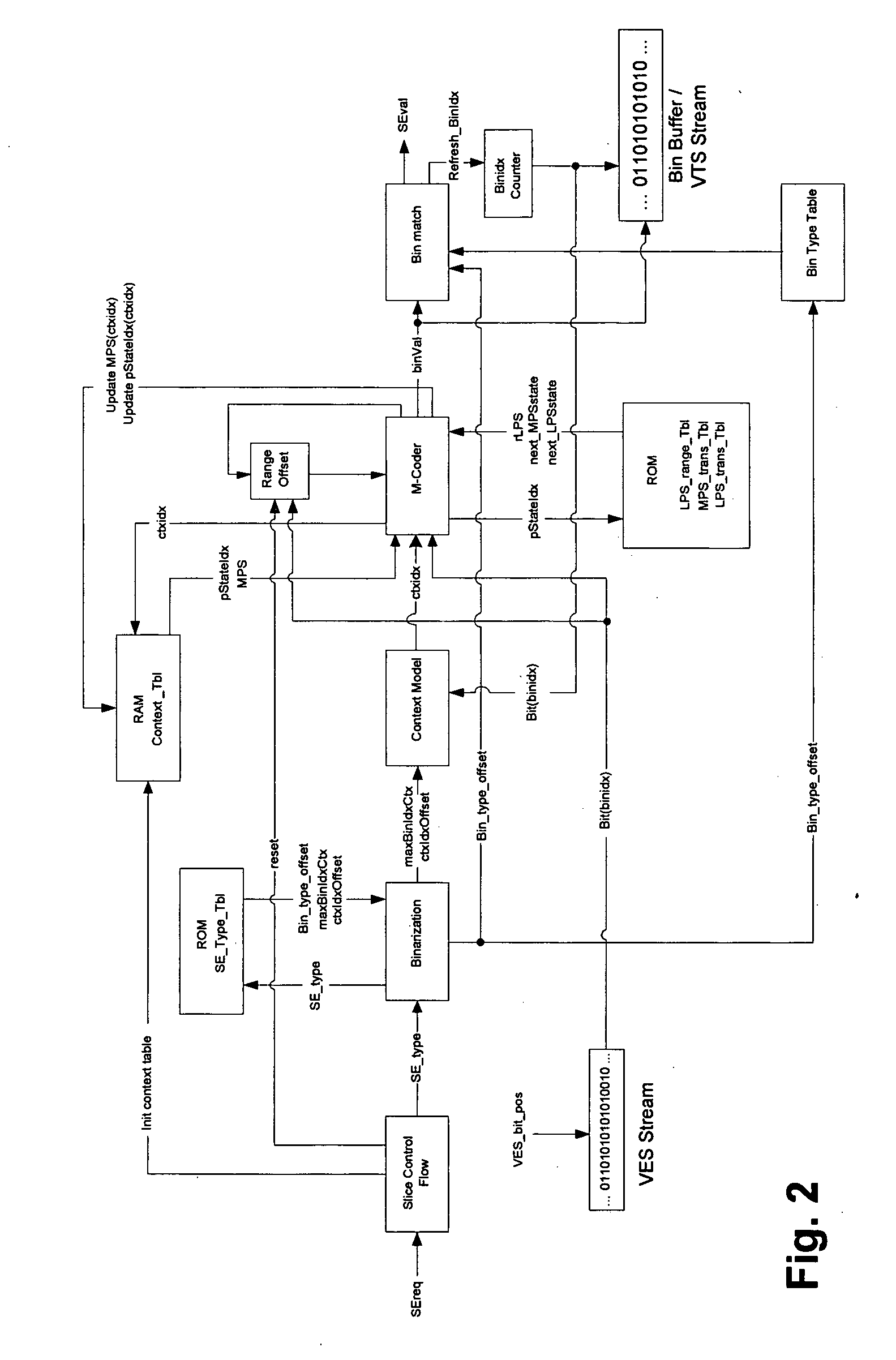

InactiveUS20060126744A1Eliminate dependenciesHigh performance throughputColor television with pulse code modulationColor television with bandwidth reductionHigh-definition televisionComputer architecture

An architecture capable of stream parsing of the H.264 Content Based Adaptive Binary Arithmetic Coding (CABAC) format is disclosed. The architecture employs a two pass dataflow approach to implement the functions of CABAC bit parsing and decoding processes (based on the H.264 CABAC algorithm). The architecture can be implemented, for example, as a system-on-chip (SOC) for a video / audio decoder for use high definition television broadcasting (HDTV) applications. Other such video / audio decoder applications are enabled as well.

Owner:MICRONAS

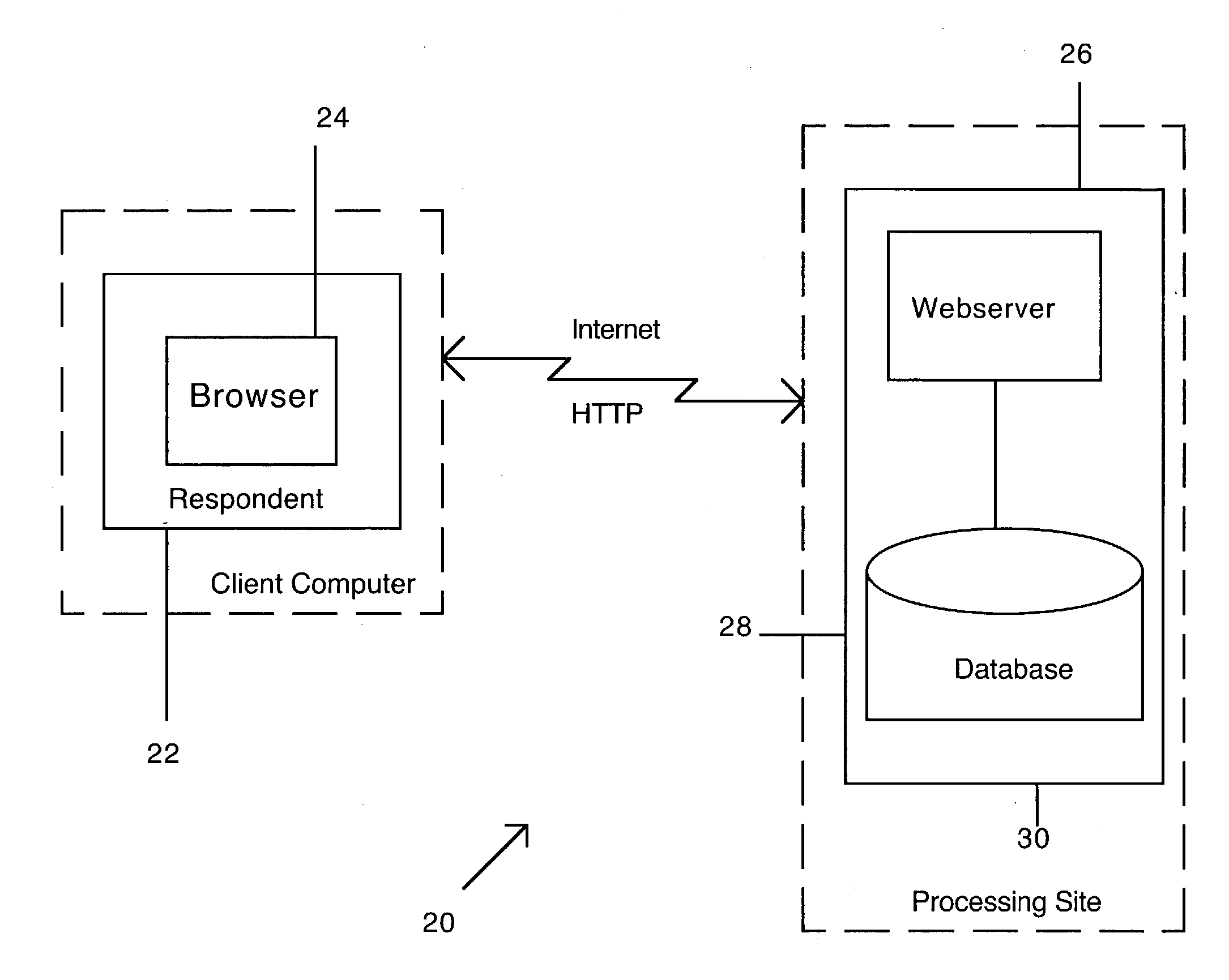

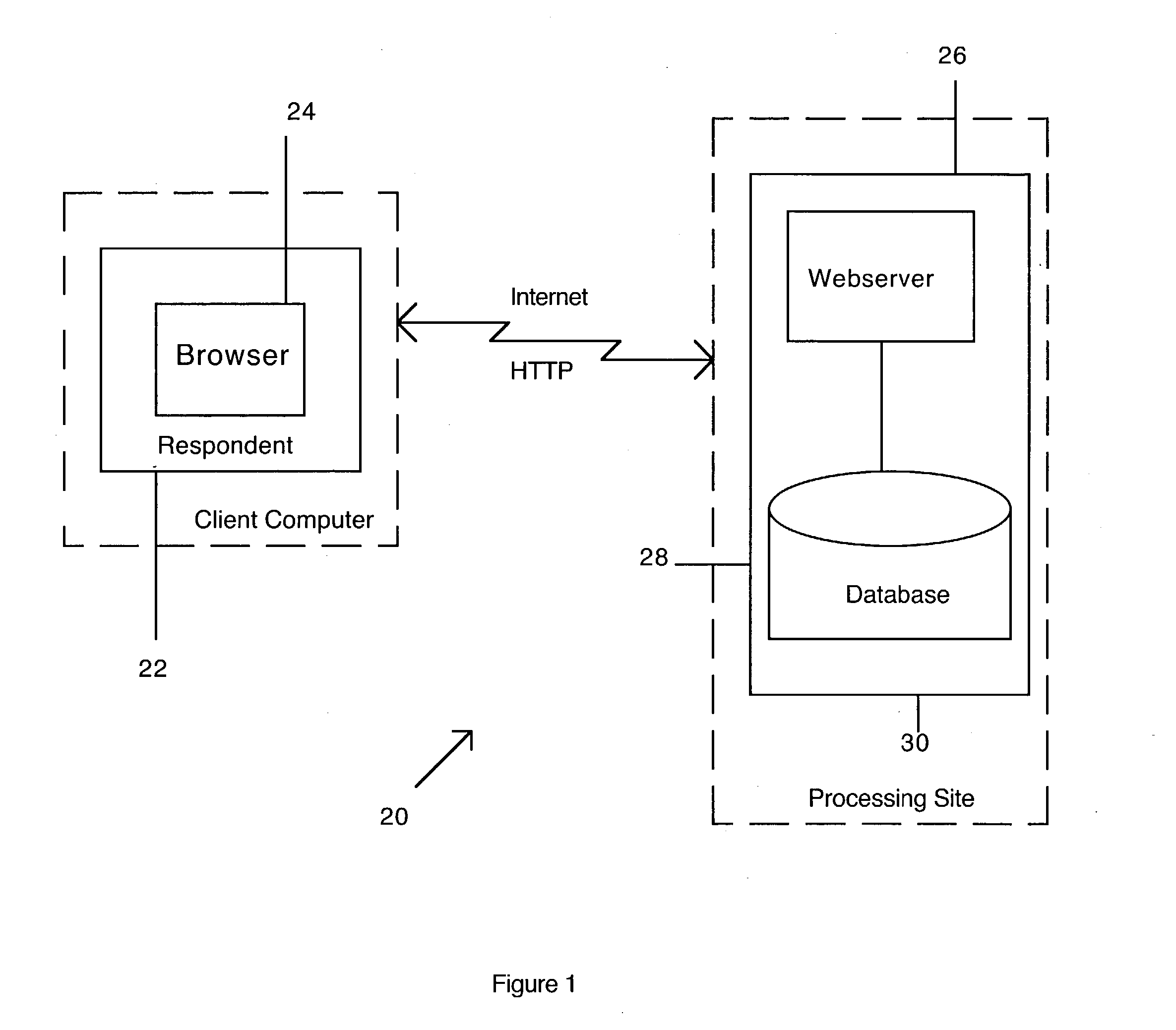

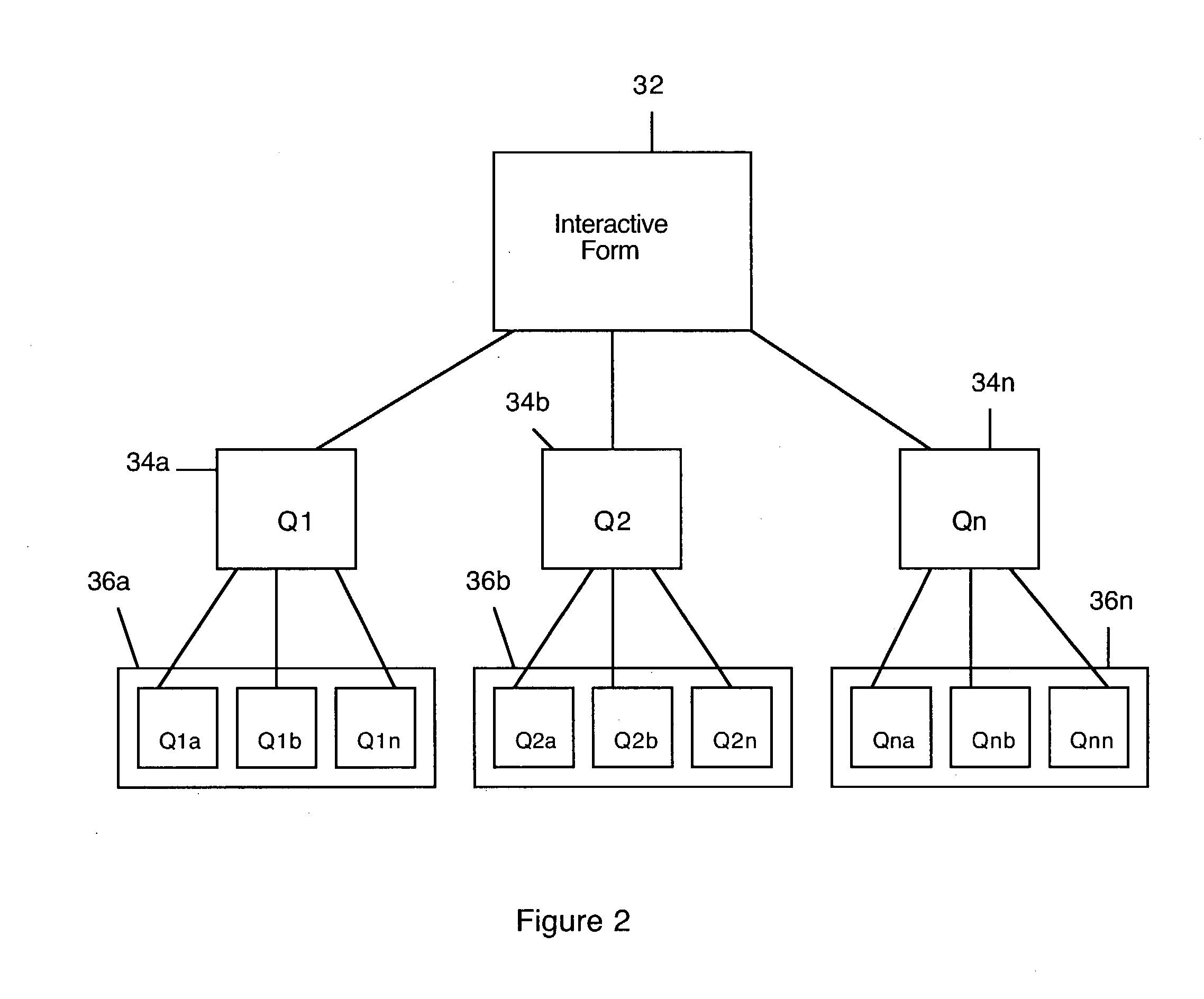

System and method for presenting computerized interactive forms to respondents using a client-server-systems technology based on web standards

InactiveUS20050086587A1Digital computer detailsNatural language data processingClient server systemsApplication software

An improved system and method for presenting computerized interactive forms (such as survey questionnaires, employment applications, etc.) via the Internet to human respondents making use of client computers. The invention is a cross-platform web application written in Java and JavaScript. The presented questions / items are selected dynamically as a respondent fills in the information for each question / item. A code-length-reducing software architecture—wherein all objects are widgets—along with a design choice of inheritance makes for maximum code clarity, impressive code compactness, and swift parsing. More information and a higher quality of information are collected from a respondent, because waiting time is reduced and only relevant questions are presented. Implementation of parent-child containment in the widget set, coupled with a JavaScript skeleton design system, facilitates respondent-friendly display design by interface designers, and a rapid design process.

Owner:BALZ CHRISTOPHER MARK

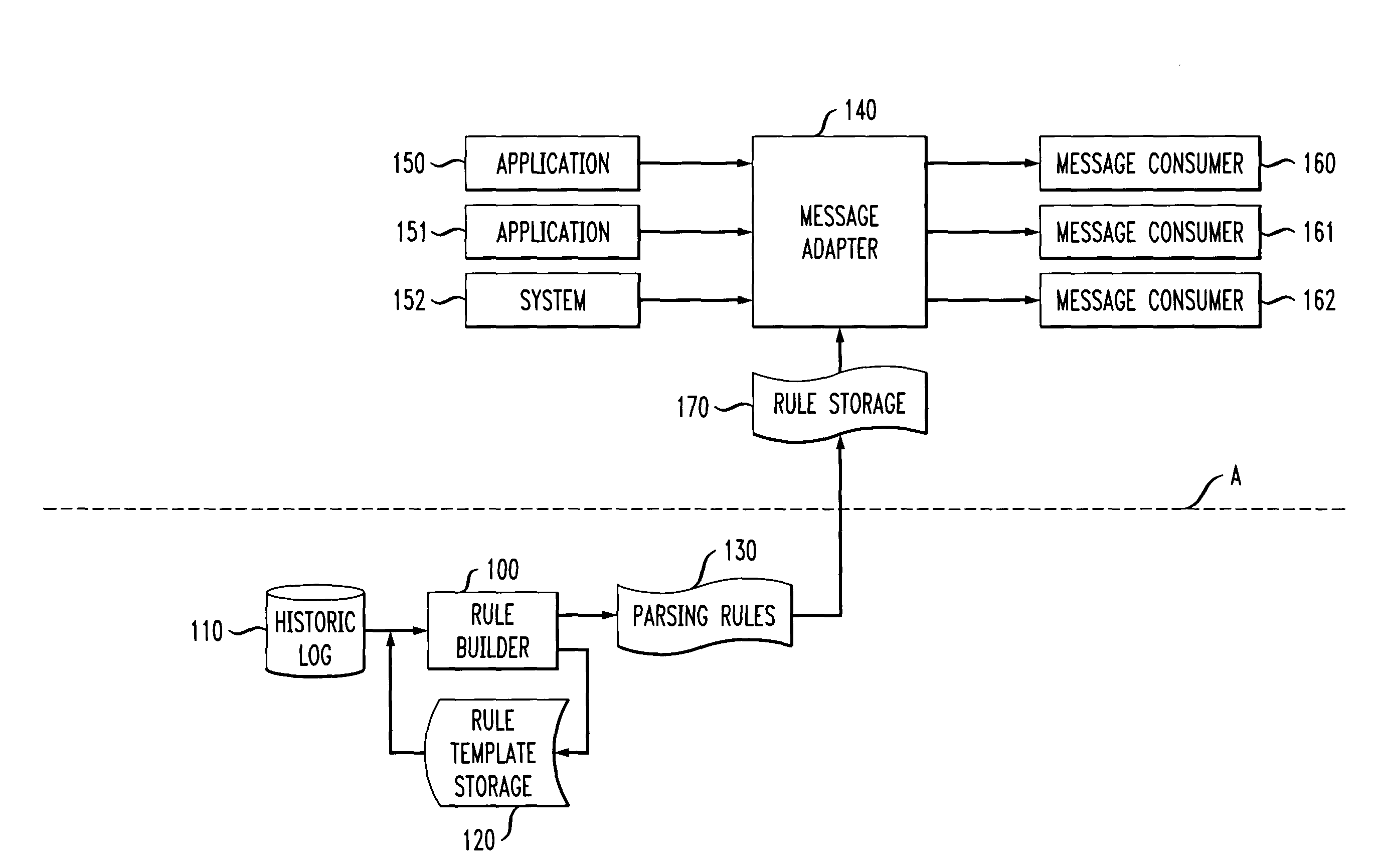

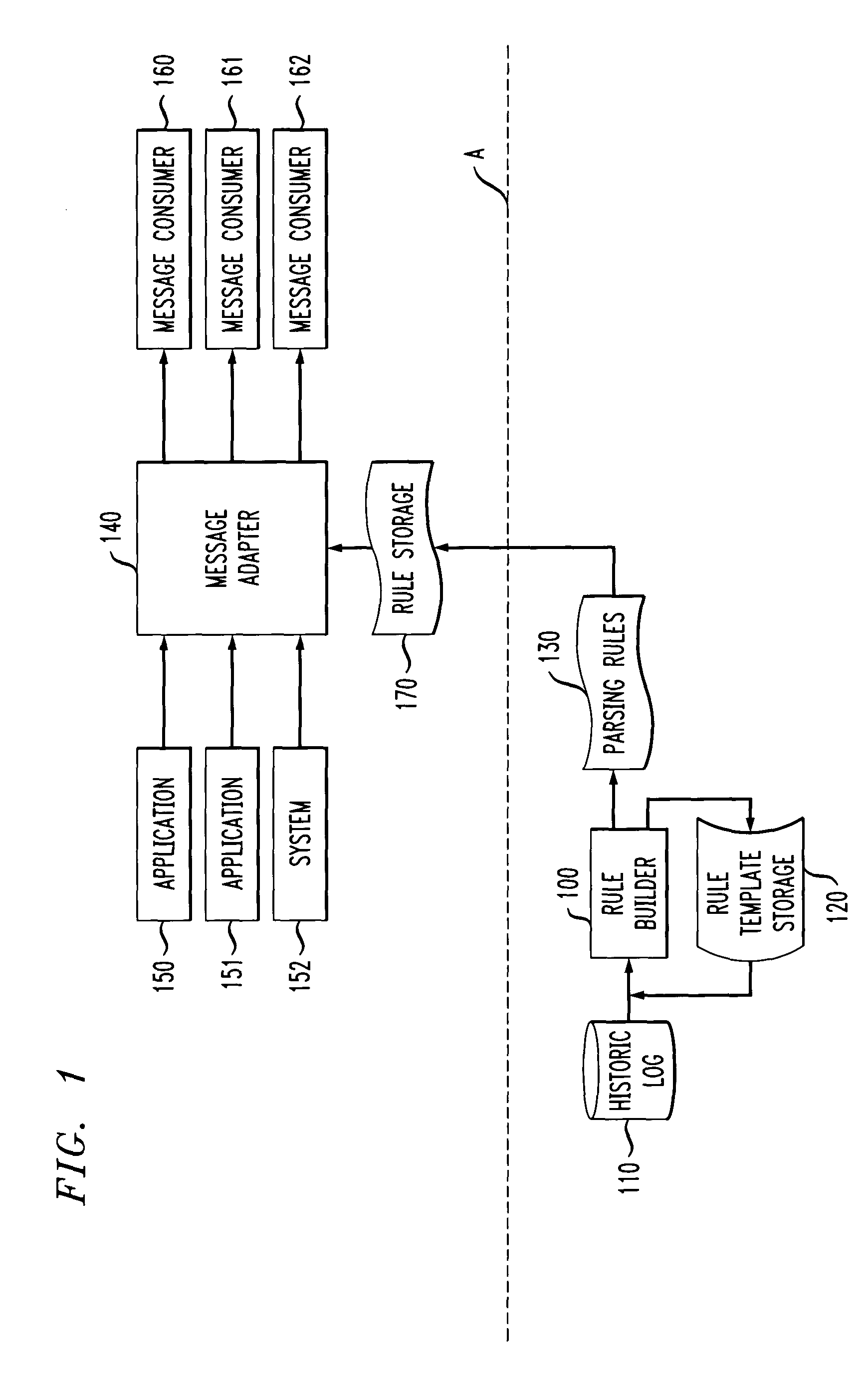

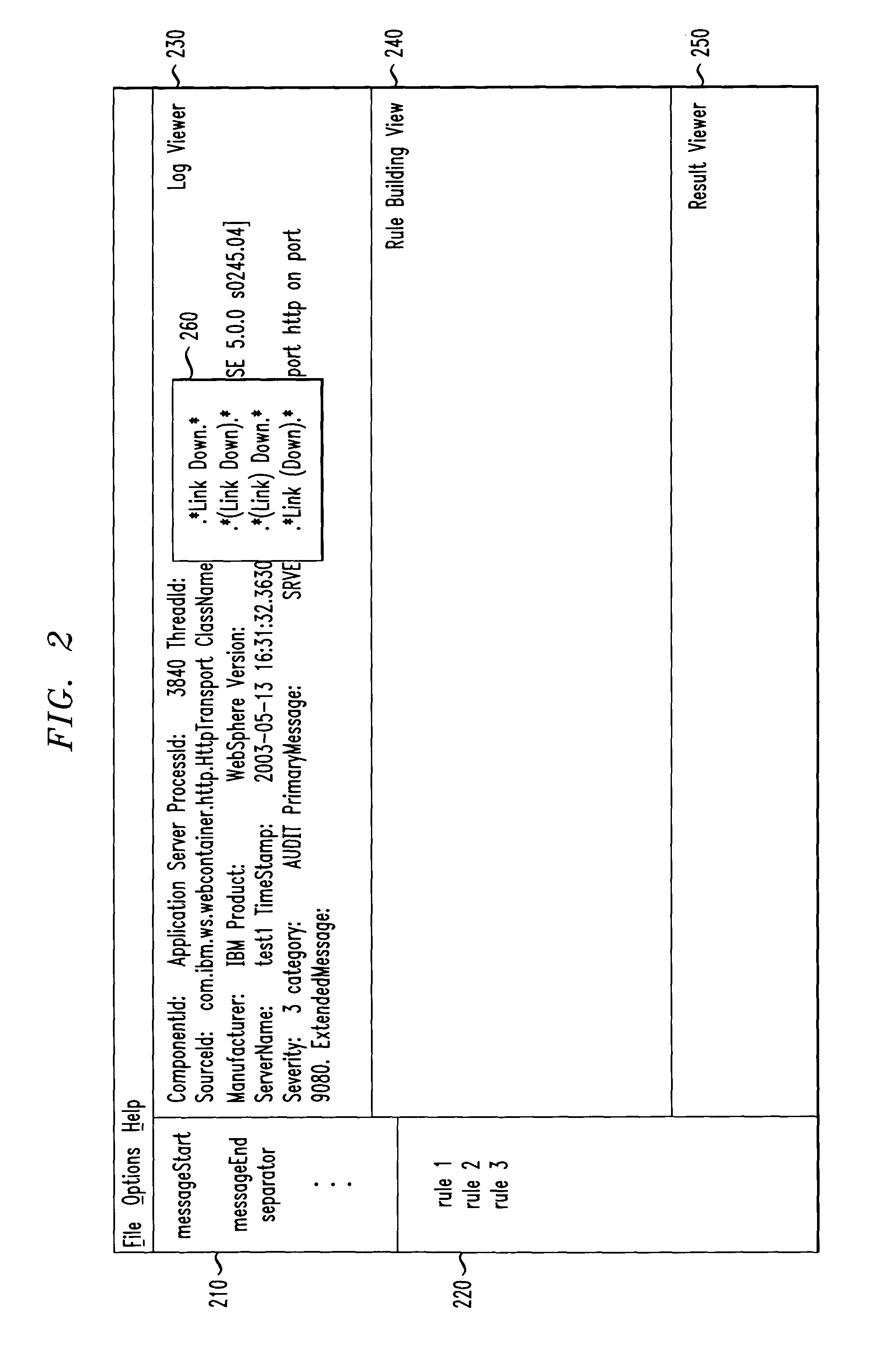

Methods and apparatus for creation of parsing rules

ActiveUS20050022207A1Realize gigabyte data reductionOvercome limitationsSoftware engineeringMultiprogramming arrangementsMessage structureData store

Techniques for parsing rule creation are provided. A technique for constructing one or more message parsing rules may comprise the following steps. First, message data representing past messages, for example, associated with a network, an application and / or a system being analyzed, is obtained. For example, this may involve reading the past or historical message data from messages logs or having a system point to the message data in existing data storage. Parsing rules are then generated by a process from one or more existing rule templates and / or based on user selection and classification of at least a portion of a message. For example, the user may choose a message part and demonstratively classify the part, for example, as a positive or negative example. The generated rules may then be stored for access by a rule-based parsing system such as a message adaptation system. Prior to generation of the one or more parsing rules, a message structure may be established upon which generation of the rules may be based.

Owner:META PLATFORMS INC

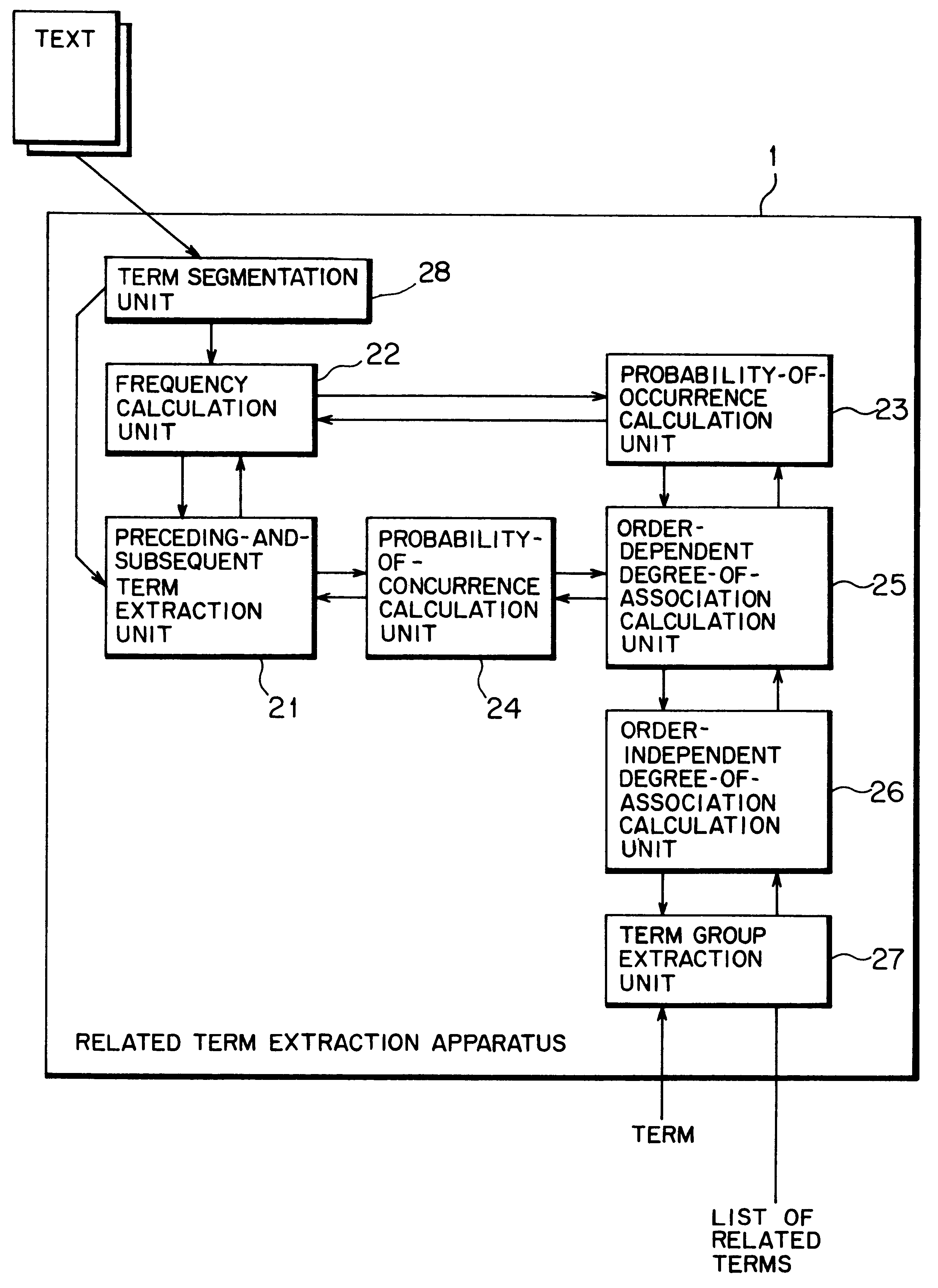

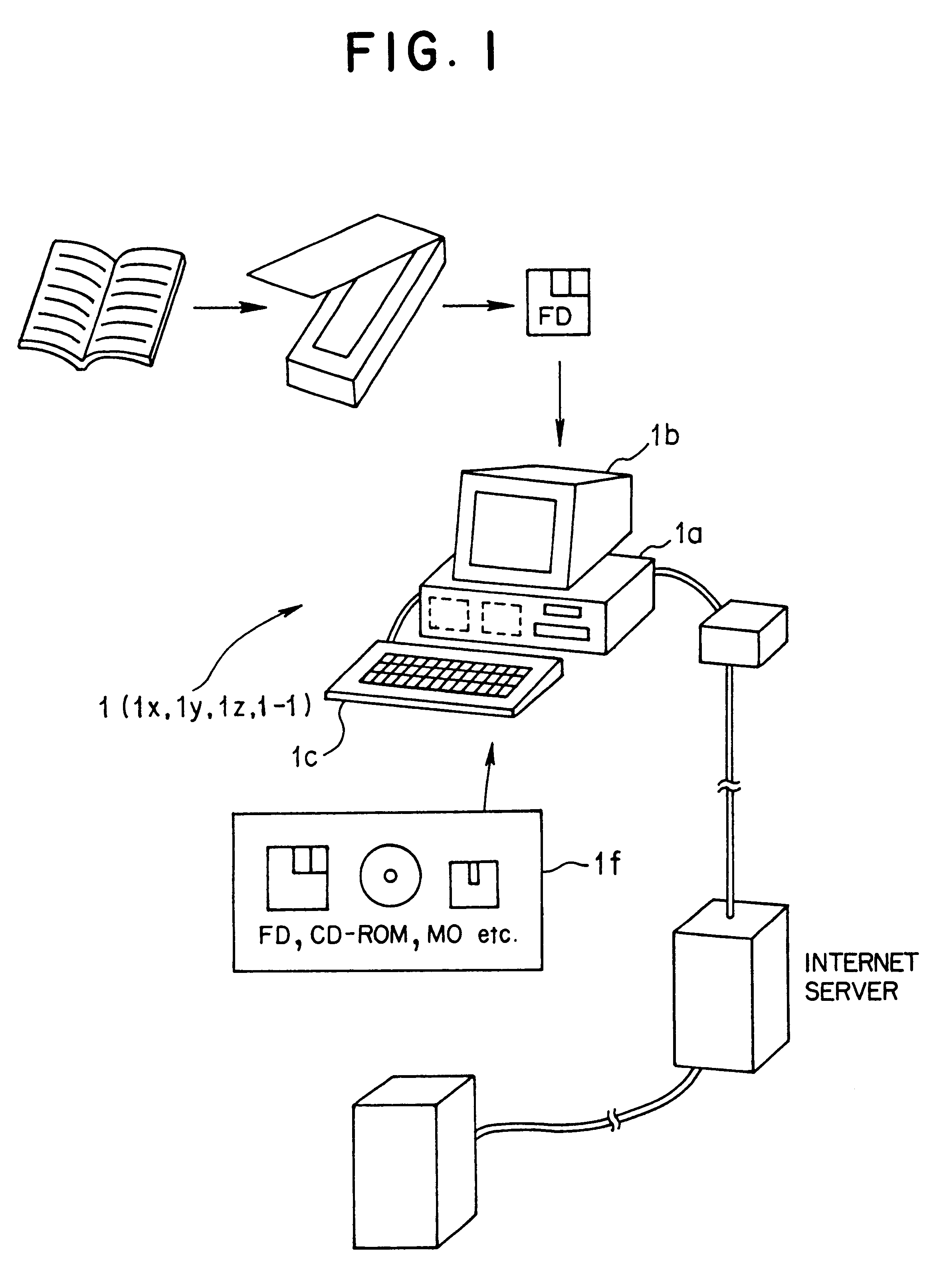

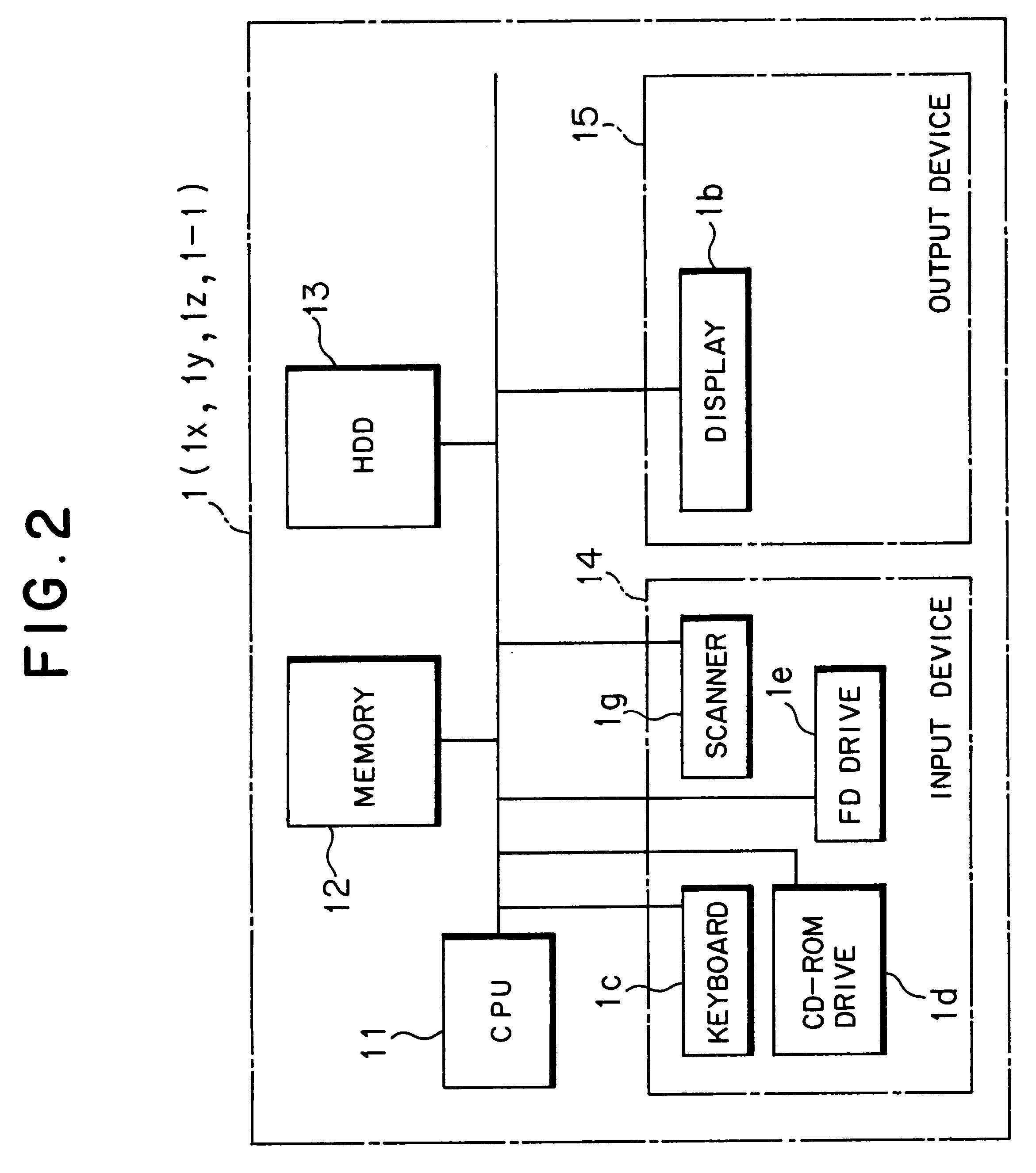

Related term extraction apparatus, related term extraction method, and a computer-readable recording medium having a related term extraction program recorded thereon

InactiveUS6178420B1Easy to understandData processing applicationsDigital data information retrievalAlgorithmTime limit

The present invention is intended to allow a user to easily and precisely extract related terms through use of mutual information without requiring morphological analysis or syntax analysis, by constituting a related term extraction apparatus from preceding-and-subsequent term extraction means for extracting a preceding term occurring prior to a specified term or a subsequent term occurring subsequent to the same in text data; a frequency calculation means for calculating the occurrence frequencies of the specified term, the preceding terms, and the subsequent terms; probability-of-occurrence calculation means for calculating the occurrence probabilities of the preceding and subsequent terms together with the occurrence probability of the specified term; probability-of-concurrence calculation means for calculating the probabilities of the preceding and subsequent terms cooccurring with the specified term; order-dependent degree-of-association calculation means for calculating an order-dependent degrees of the preceding and subsequent terms cooccurring with the specified term; order-independent degree-of-association calculation means for calculating an order-independent degrees of occurrence of the preceding and subsequent terms with the specified term; and term group extraction means for extracting from the text data a group of terms related to the specified term, on the basis of the degree-of-association information calculated by the order-independent degree-of-association calculation means.

Owner:FUJITSU LTD

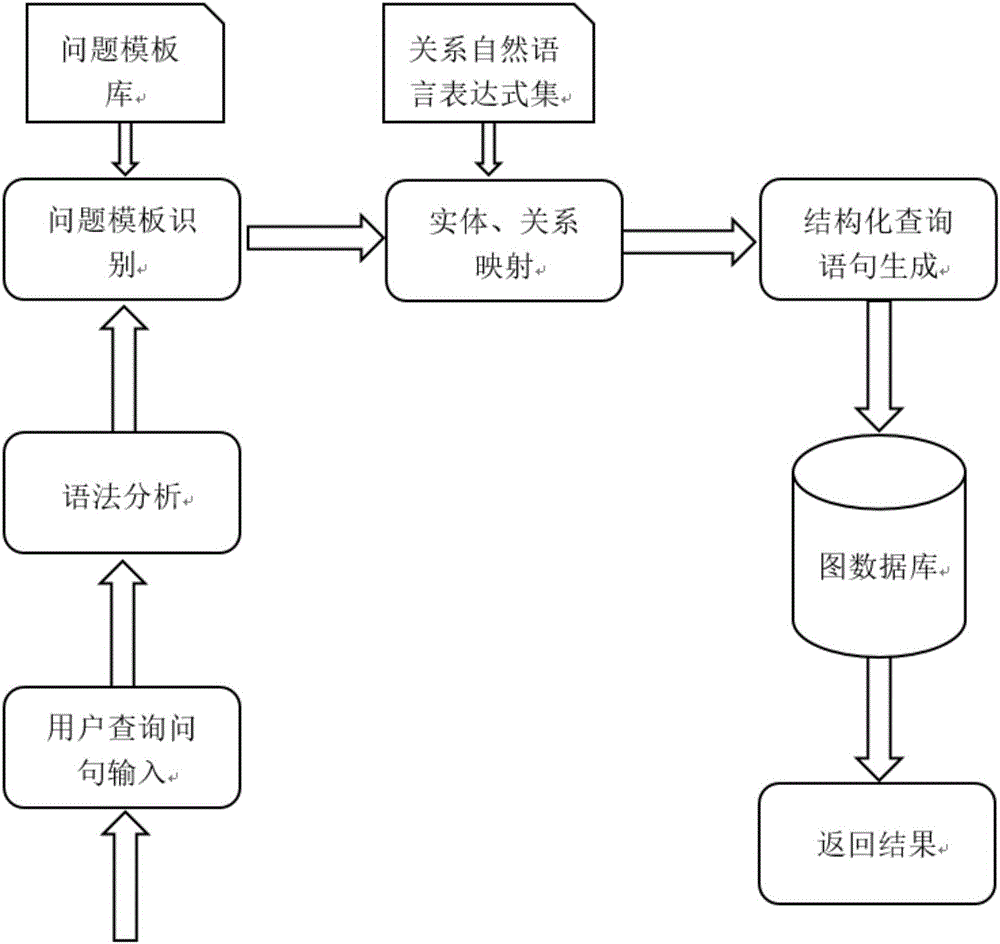

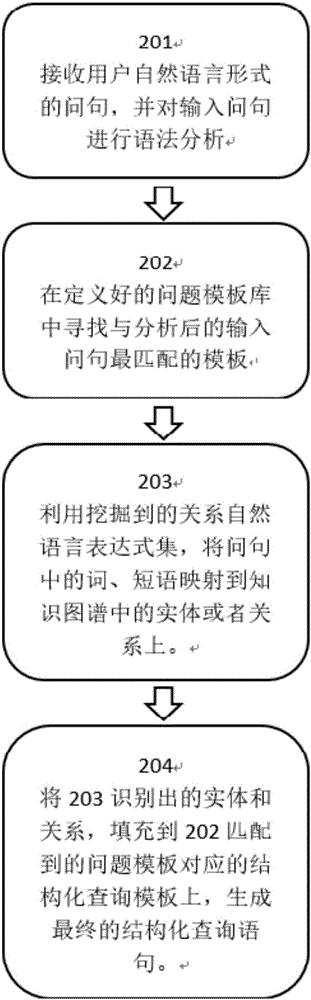

Mapping knowledge domain questioning and answering system and method based on template matching technique

InactiveCN105868313AImprove search satisfactionNatural language data processingSpecial data processing applicationsQuery statementParsing

The invention discloses a mapping knowledge domain questioning and answering system and method based on a template matching technique. The system comprises an offline module and an online module, wherein the offline module is mainly used for offline data preparation, and the online module is mainly used for system service. The system can support a friendly natural language question of a user to serve as a query, grammatical analysis is conducted on the question of the user, an offline-defined manual template library is searched for a matched question template according to a result obtained through grammatical analysis, a final structurized mapping knowledge domain query statement is generated according to an entity matching method and a relation matching method, retrieving is conducted in a mapping knowledge domain according to the structurized query statement, and then a final result is returned. According to the mapping knowledge domain questioning and answering system and method based on the template matching technique, the precise retrieving result can be given for the question of the user, and the searching satisfaction degree of the user is improved.

Owner:ZHEJIANG UNIV

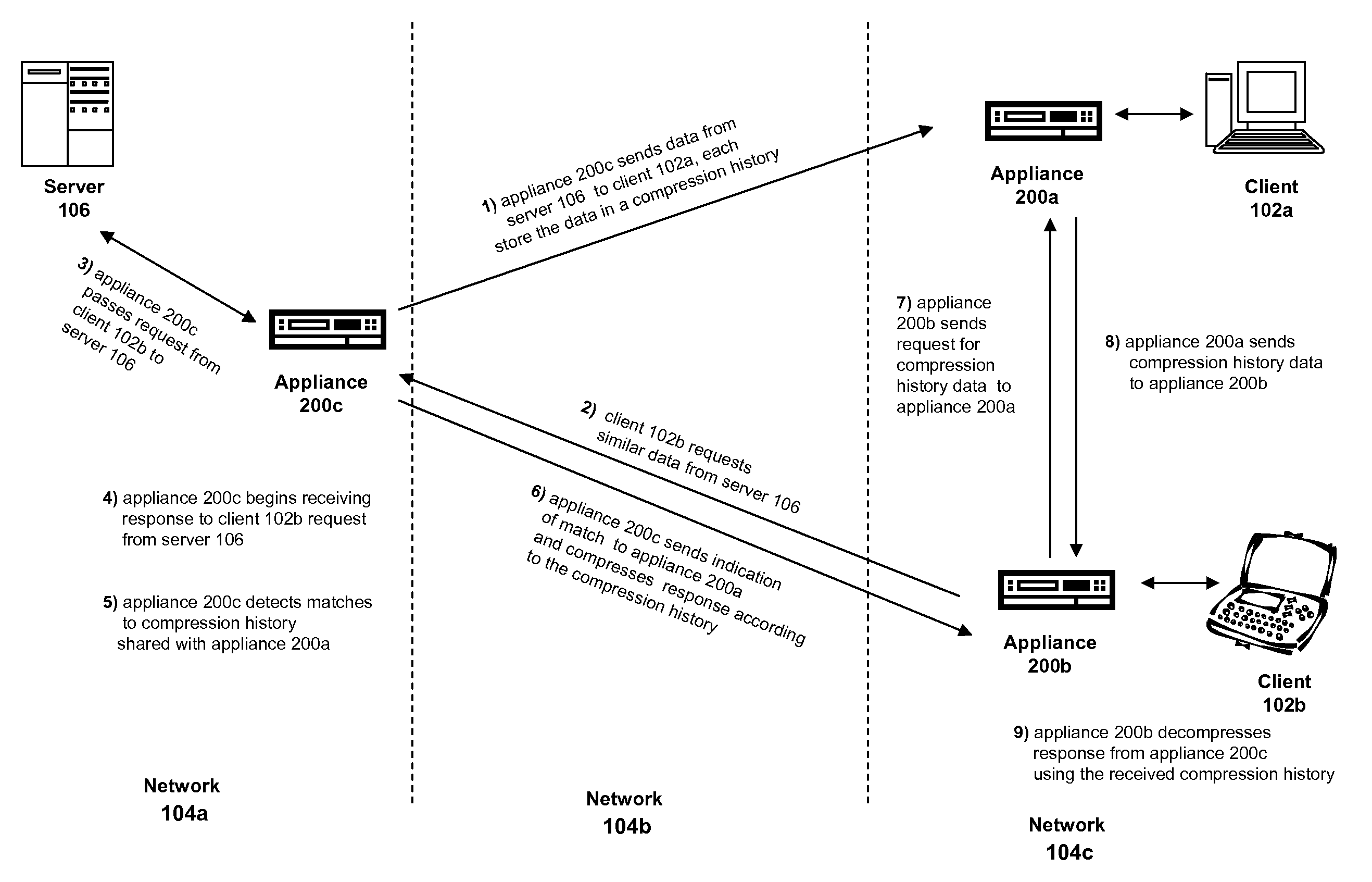

Systems and methods for sharing compression histories between multiple devices

ActiveUS7532134B2Improve compression efficiently and speedIncrease the lengthElectric signal transmission systemsCharacter and pattern recognitionApplication specificParsing

Systems and methods of storing previously transmitted data and using it to reduce bandwidth usage and accelerate future communications are described. By using algorithms to identify long compression history matches, a network device may improve compression efficiently and speed. A network device may also use application specific parsing to improve the length and number of compression history matches. Further, by sharing compression histories and compression history indexes across multiple devices, devices can utilize data previously transmitted to other devices to compress network traffic. Any combination of the systems and methods may be used to efficiently find long matches to stored data, synchronize the storage of previously sent data, and share previously sent data among one or more other devices.

Owner:CITRIX SYST INC

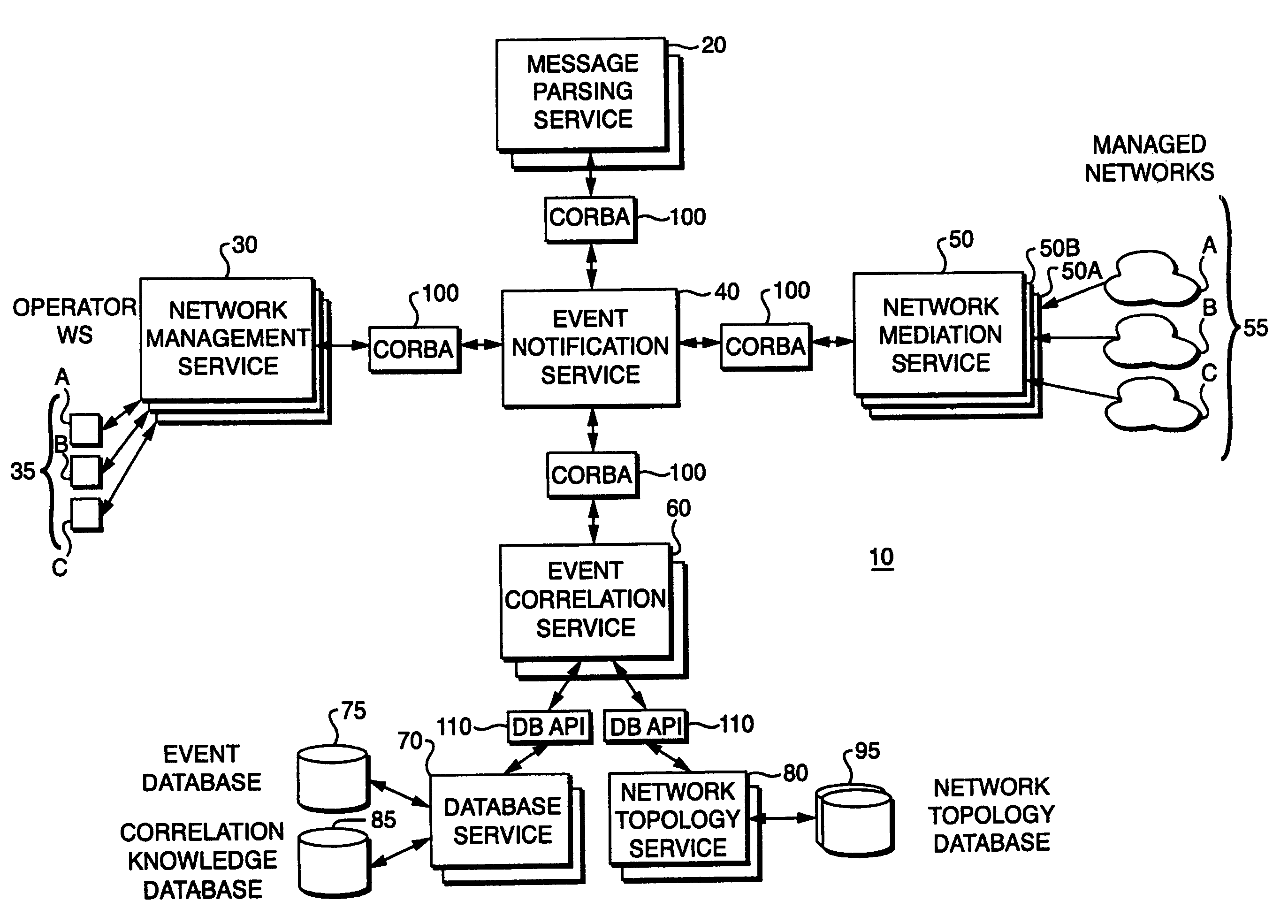

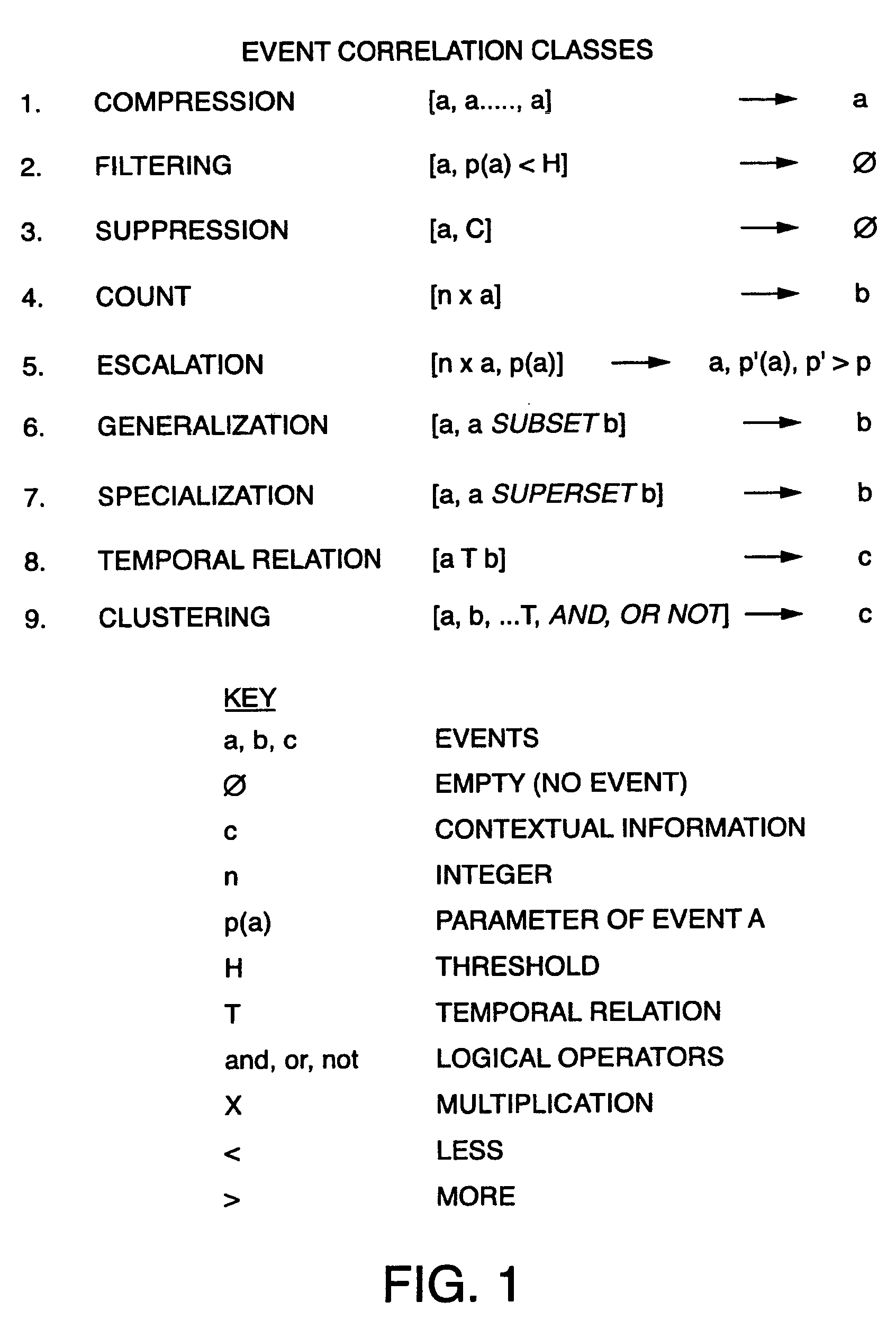

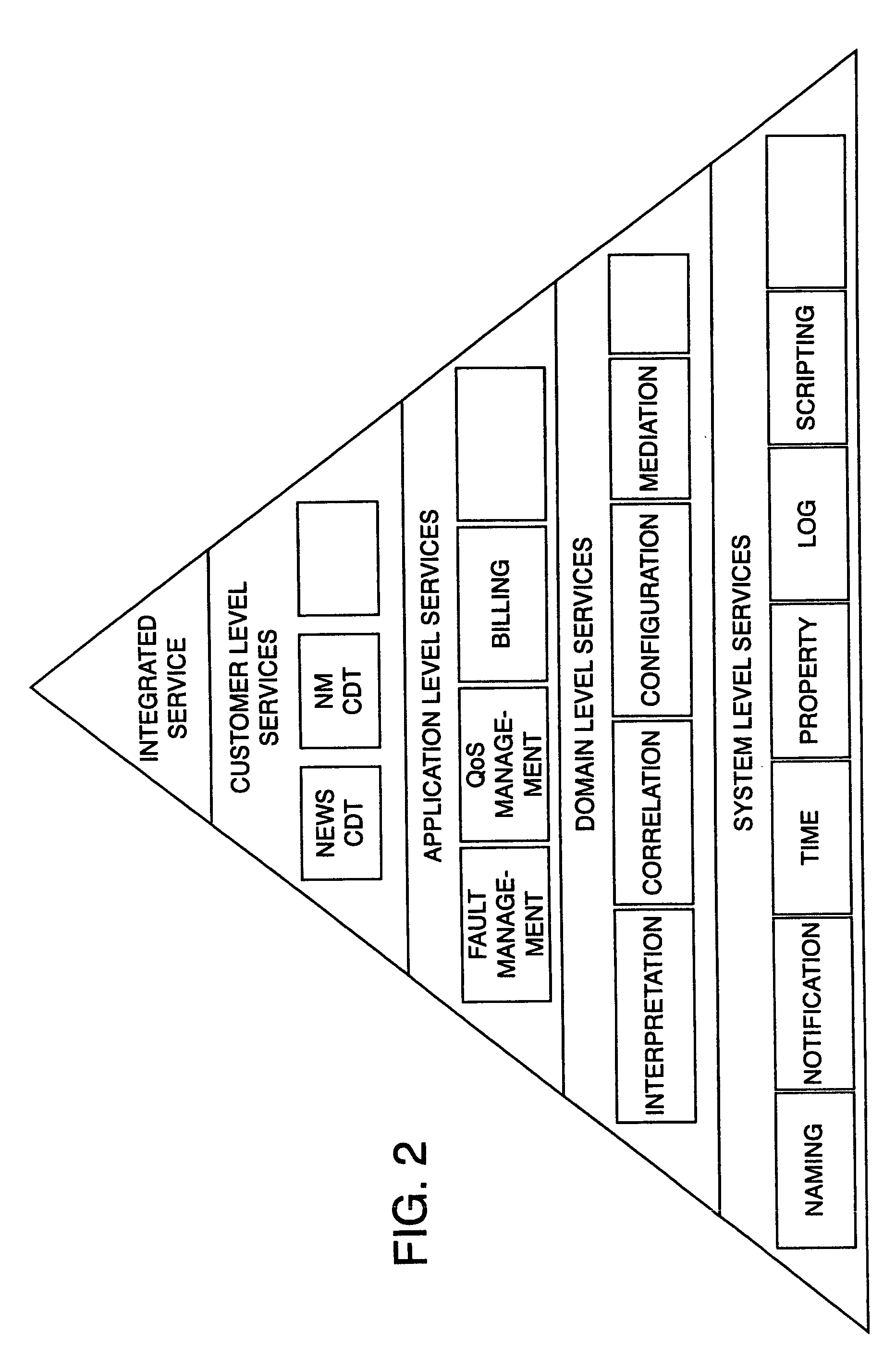

System and method for providing a global real-time advanced correlation environment architecture

InactiveUS6941557B1Easy to replaceFacilitate communicationDigital computer detailsMultiprogramming arrangementsData processing systemNetwork management

A method and system are disclosed for efficiently correlating network events within a data processing system and then transmitting messages to various network entities in response to an occurrence of a particular network event. According to the present invention, a network mediation service receives raw message streams from one or more external networks and passes the streams in real-time to the event notification service. The event notification service then passes the message to the message parsing service for processing. After the message has been parsed by the message parsing service, it is passed back to the event notification service which passes the message along an event channel to the network management service. The message is also passed to the event correlation service for event correlation. A knowledge-based database of message classes that define how to interpret the message text are used by the event correlation service to match correlation rule conditions to the observed events. After event correlation service processes the parsed event, it is passed to the network management service for resolution.

Owner:VERIZON LAB

Systems and methods of using application and protocol specific parsing for compression

ActiveUS7619545B2Improve compression efficiently and speedIncrease the lengthError preventionTransmission systemsTraffic capacityApplication specific

Systems and methods of storing previously transmitted data and using it to reduce bandwidth usage and accelerate future communications are described. By using algorithms to identify long compression history matches, a network device may improve compression efficiently and speed. A network device may also use application specific parsing to improve the length and number of compression history matches. Further, by sharing compression histories, compression history indexes and caches across multiple devices, devices can utilize data previously transmitted to other devices to compress network traffic. Any combination of the systems and methods may be used to efficiently find long matches to stored data, synchronize the storage of previously sent data, and share previously sent data among one or more other devices.

Owner:CITRIX SYST INC

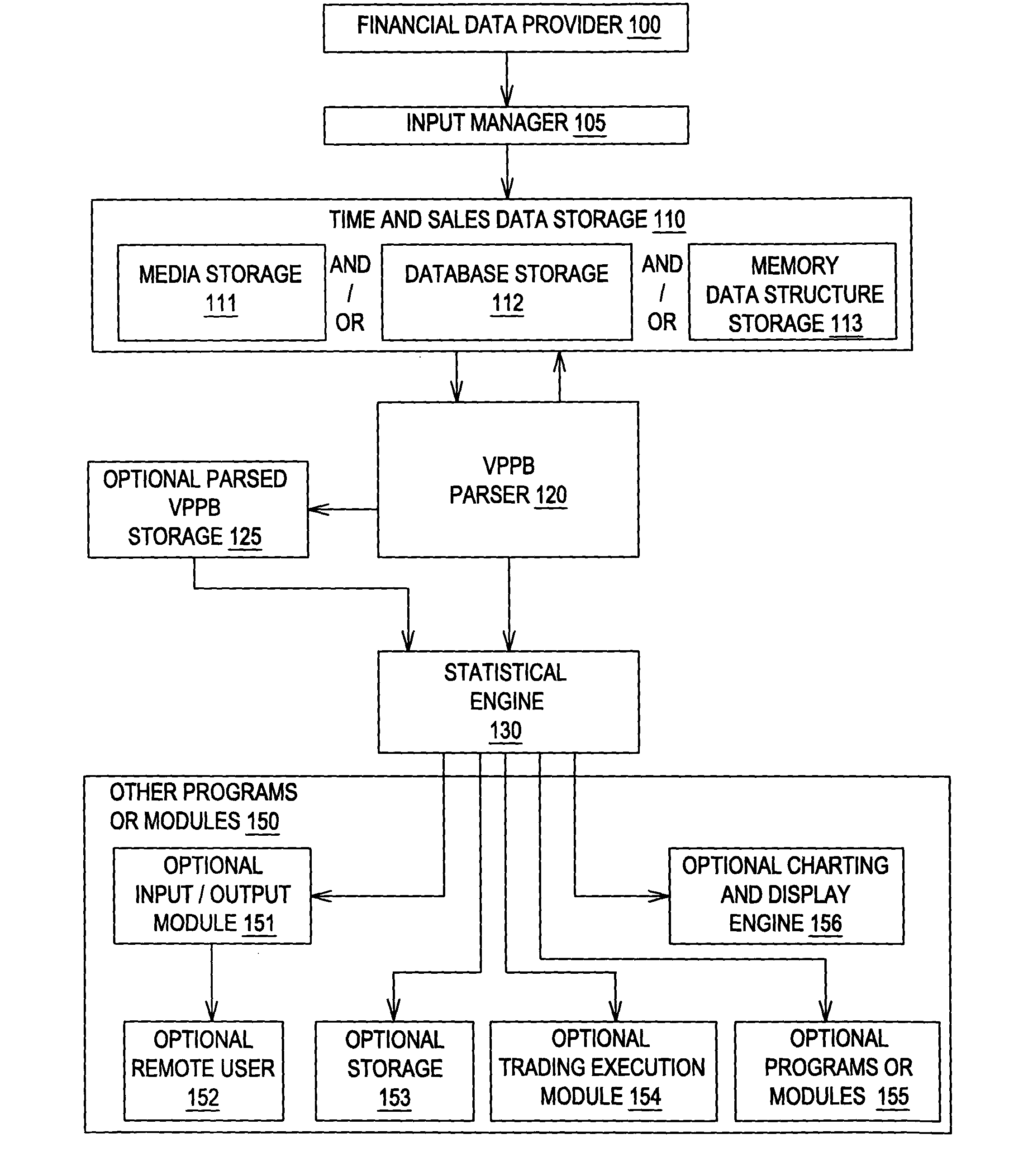

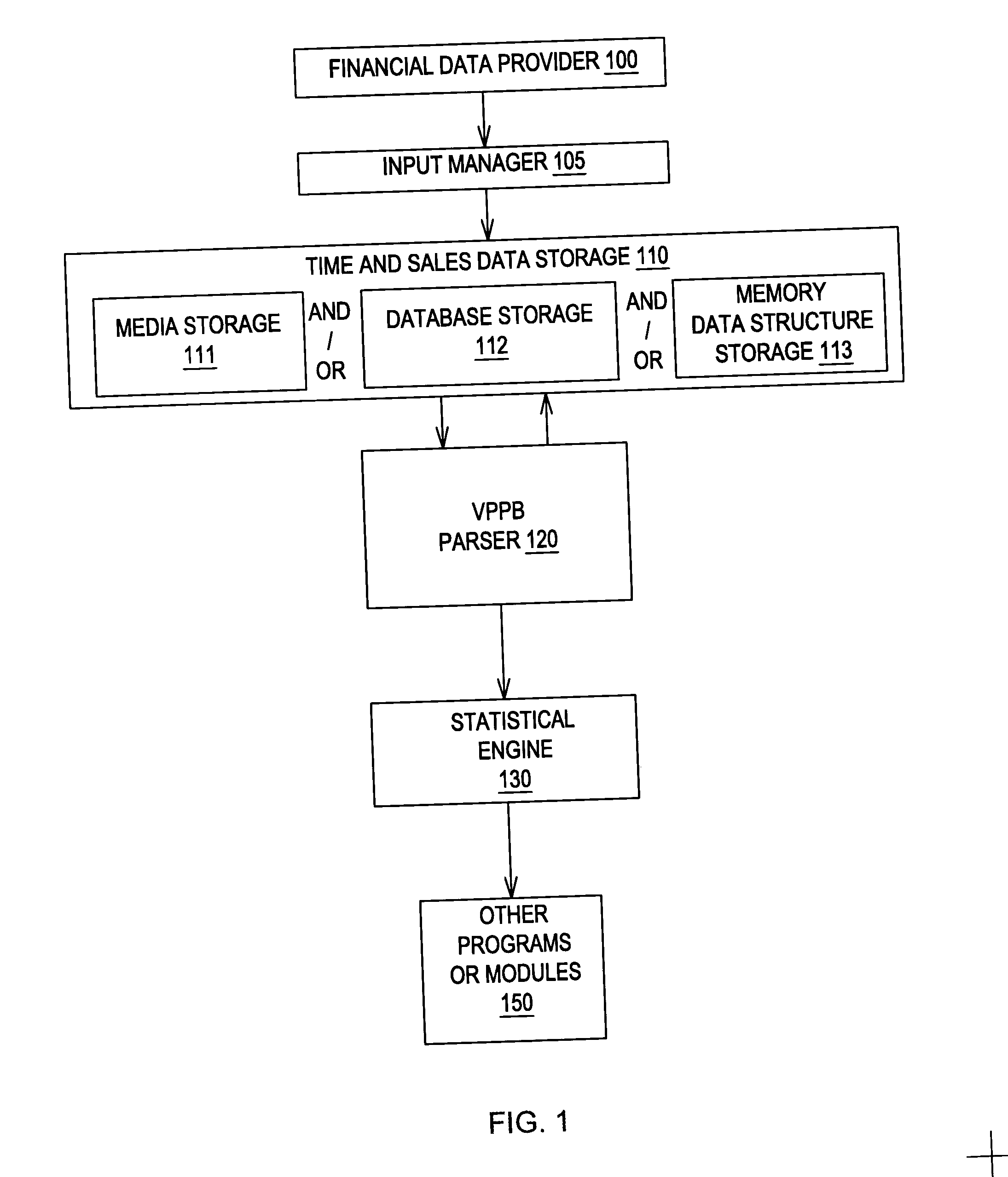

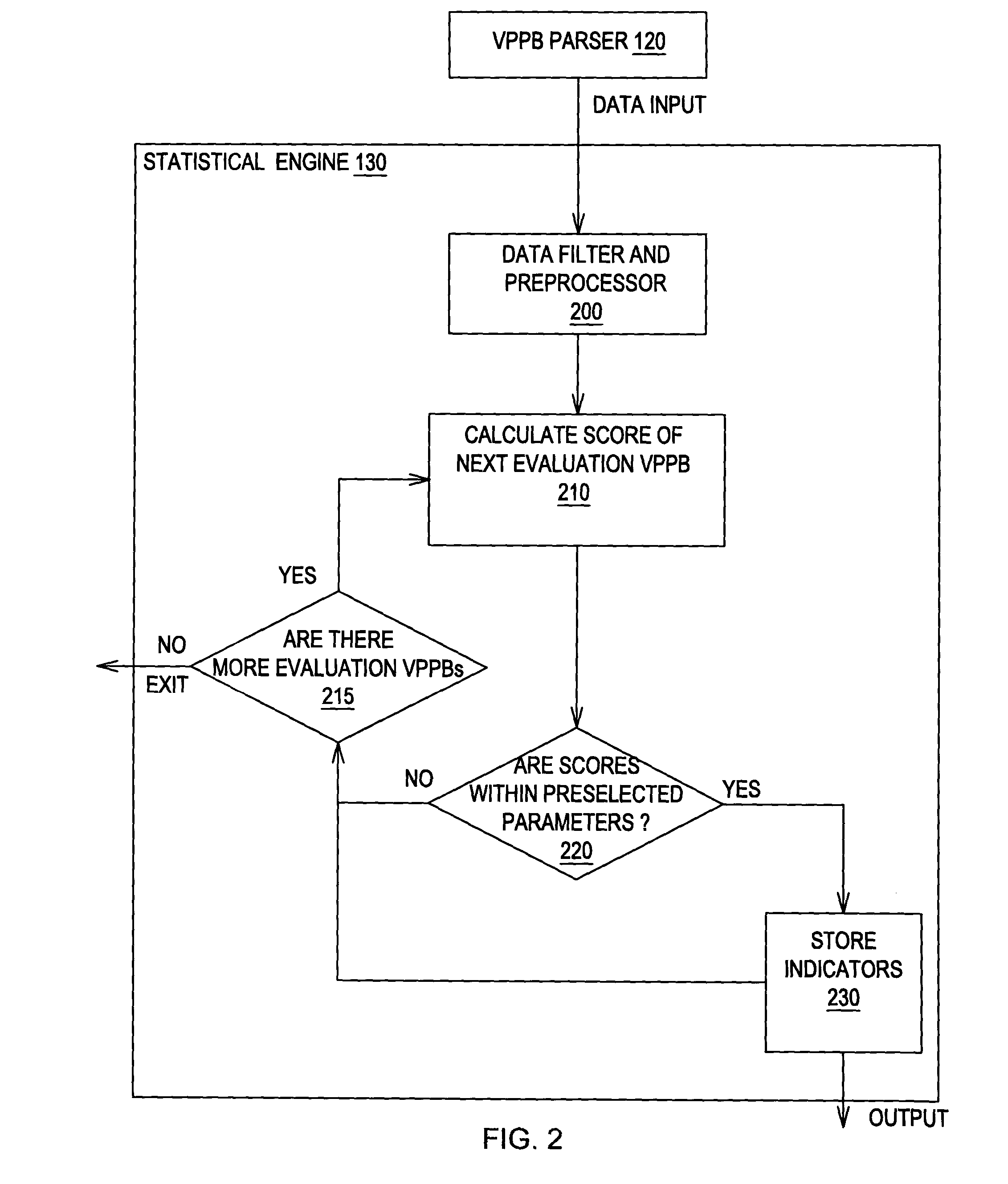

Computer Implemented Method and System of Trading Indicators Based on Price and Volume

InactiveUS20040225592A1UnderstandingEasy to optimizeFinanceDigital computer detailsTime lagData provider

A method and system for providing trading indicators for selected instruments traded in a market such as stocks, currency contracts, bonds, commodities contracts, options contracts, and futures contracts. The method and system create trading indicators using Time and Sales data as provide by exchanges or financial data providers. The method comprise parsing time, price and volume of individual transactions into a collection of volume per price bracket per time interval quantities, wherein each quantity is an aggregate volume of transactions executed during one of a set of sequential time intervals and executed at prices within one of a set of price brackets. The method generate trading indicators by using mathematical algorithms to score individual volume per price bracket per time interval quantities corresponding to an evaluation time interval against a population of individual volume per price bracket per time interval quantities corresponding to a set of previous time intervals. The system generates trading indicators in real time, without the time lag associated to traditional technical analysis indicators. The method and system can also generate trend indicators based on analysis of volume accumulation, and defines trading indicators based on maximum volume prices.

Owner:CHURQUINA EDUARDO ENRIQUE

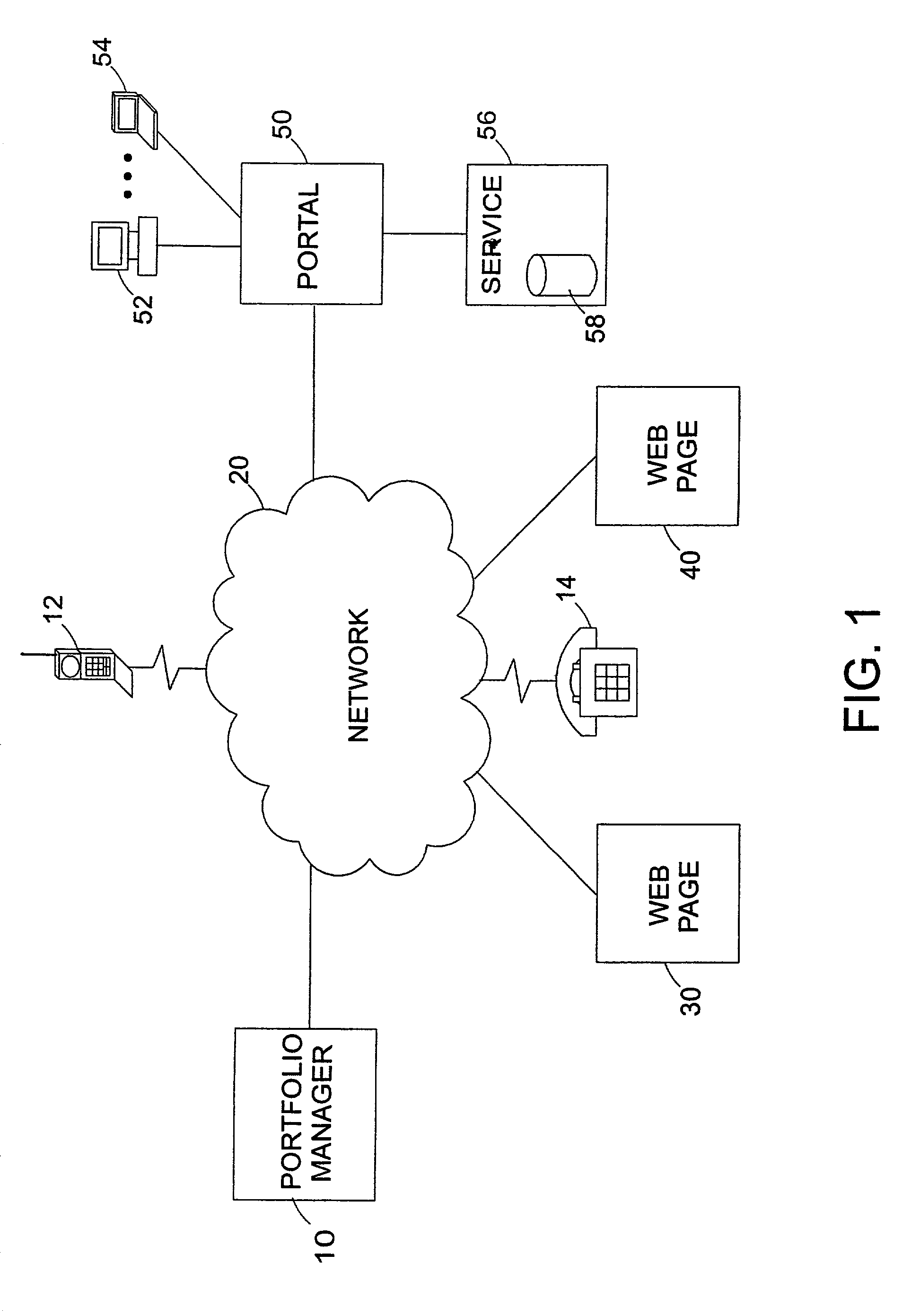

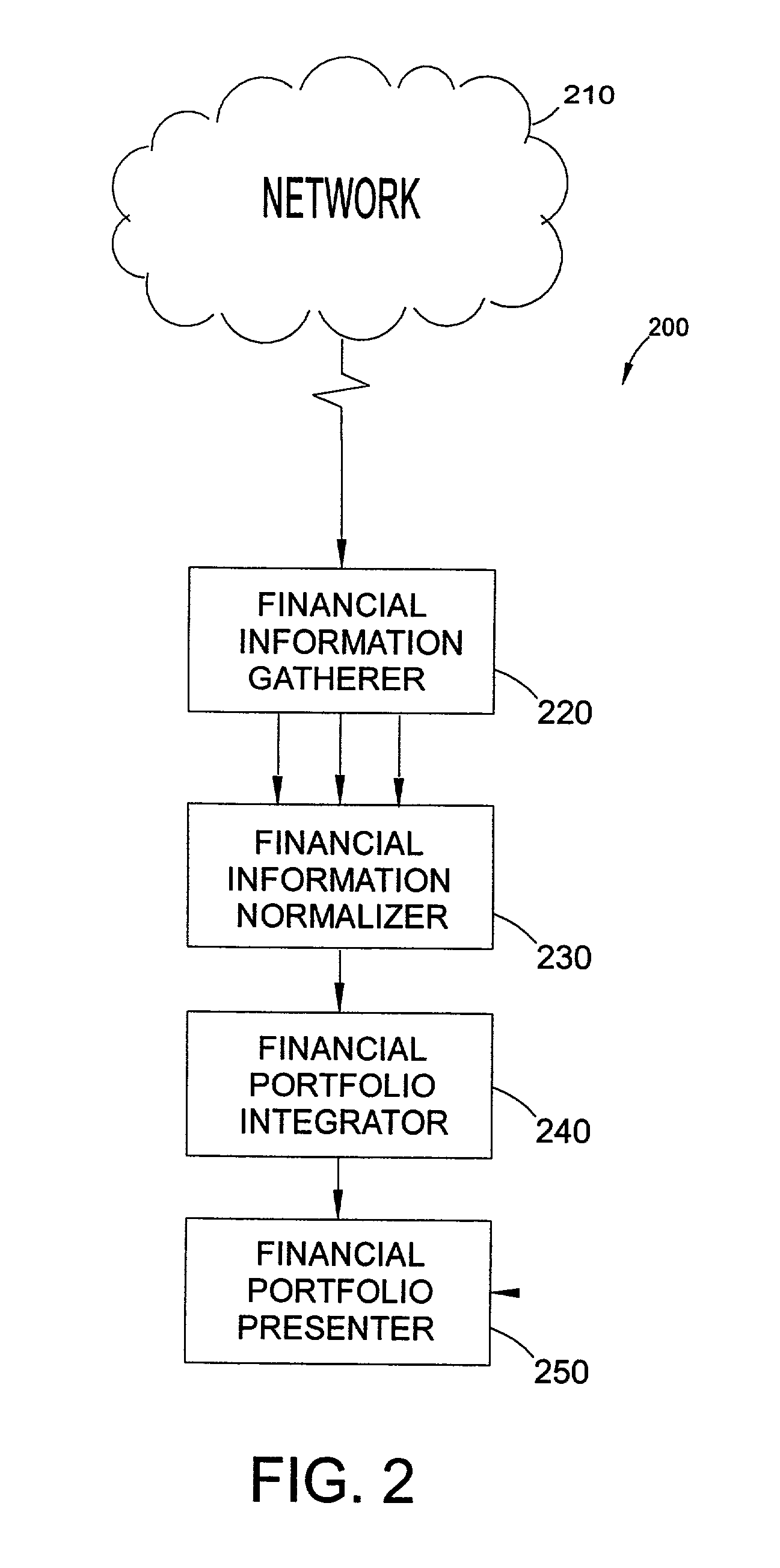

Financial portfolio management system and method

A financial portfolio management system operable in a network environment can be configured to gather financial information from a plurality of sources over an electronic network and intelligently aggregate the information into a financial portfolio viewable by a client. The client can determine which accounts should be included in the portfolio. The system uses web crawling, parsing, or spidering technology to update the portfolio information. The system provides one platform that conveys financial information from a variety of accounts held at several different financial institutions.

Owner:MORNINGSTAR INC

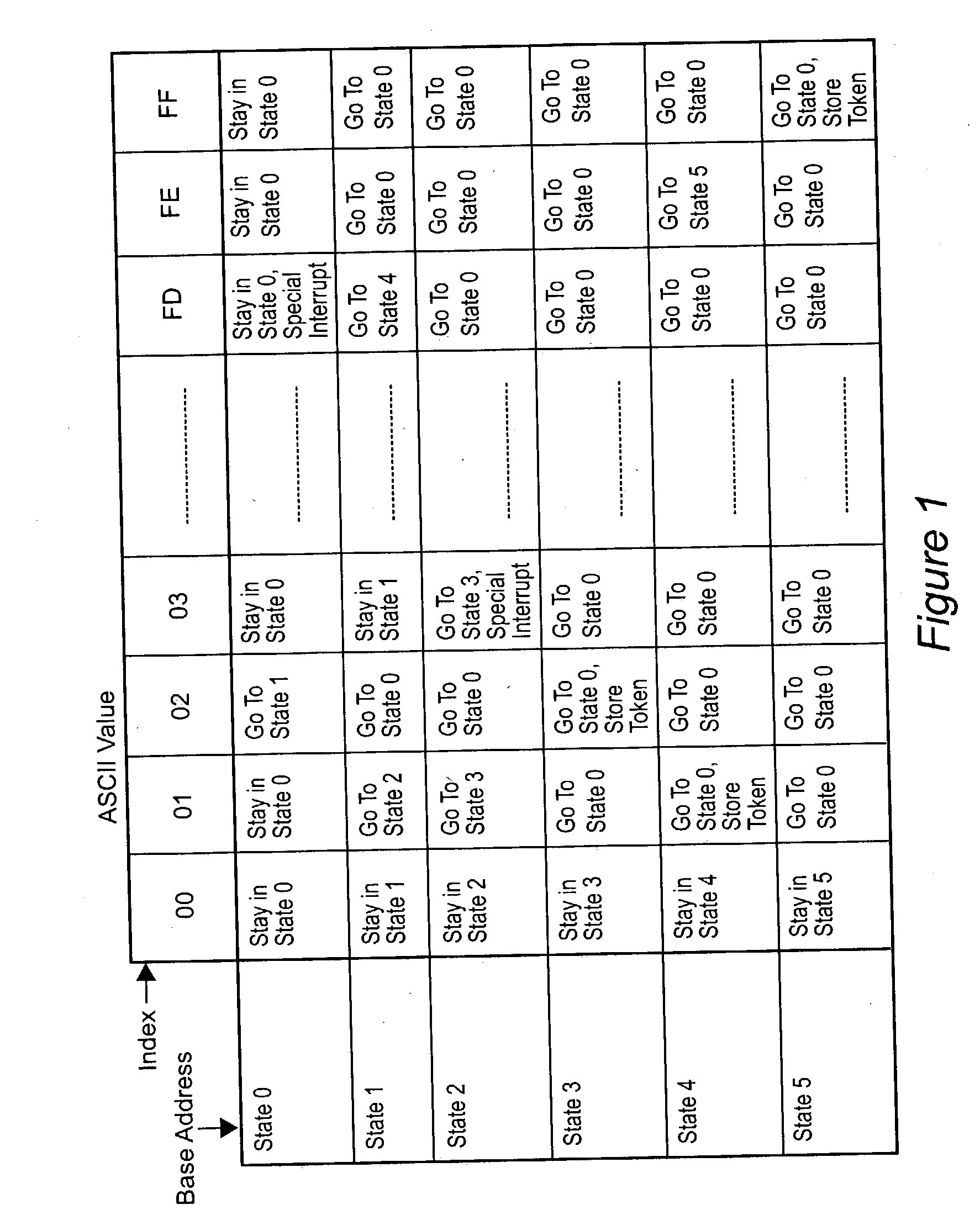

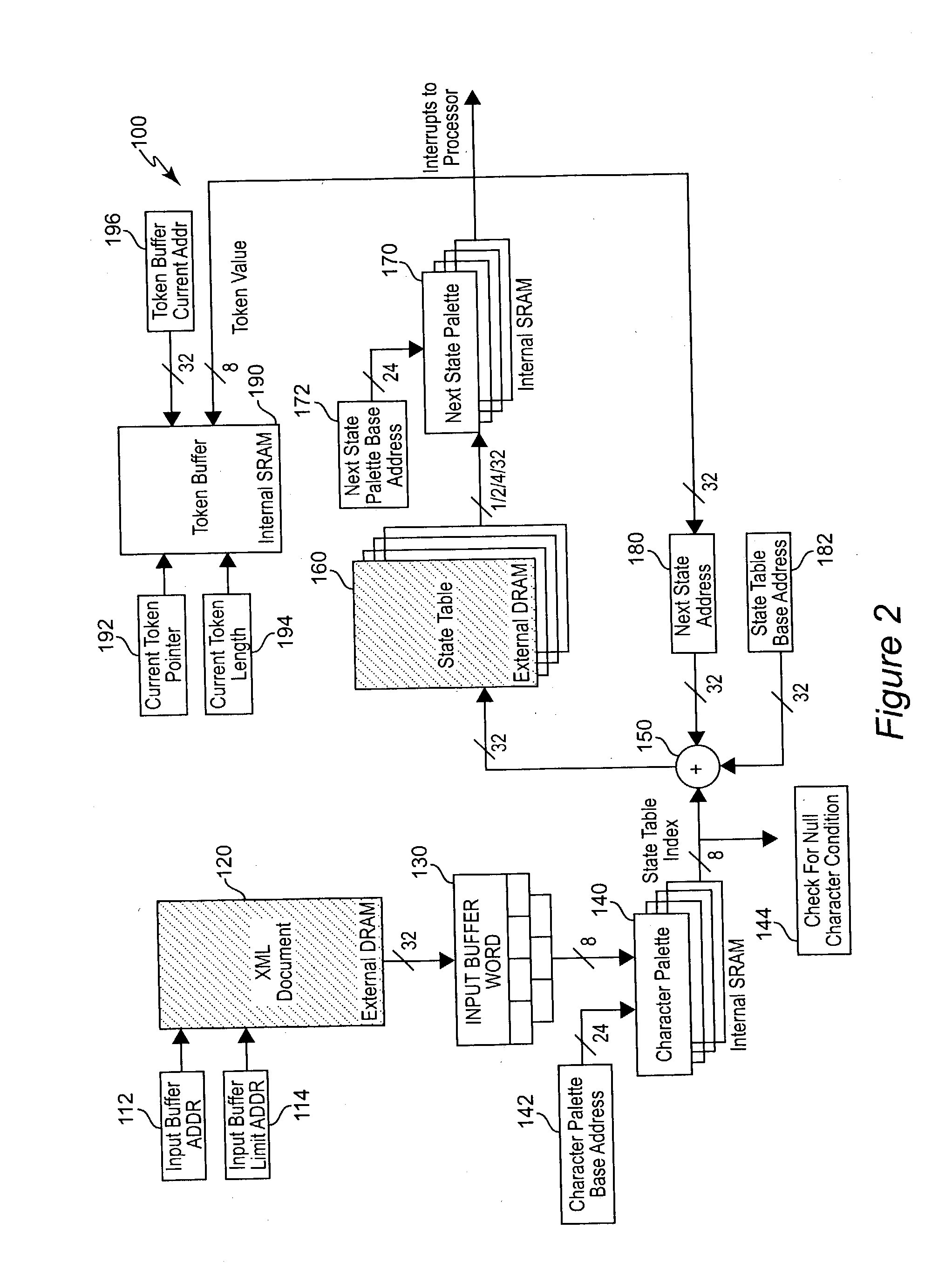

Hardware parser accelerator

InactiveUS20040083466A1Software engineeringNatural language data processingHigh speed memoryTrace table

Dedicated hardware is employed to perform parsing of documents such as XML(TM) documents in much reduced time while removing a substantial processing burden from the host CPU. The conventional use of a state table is divided into a character palette, a state table in abbreviated form, and a next state palette. The palettes may be implemented in dedicated high speed memory and a cache arrangement may be used to accelerate accesses to the abbreviated state table. Processing is performed in parallel pipelines which may be partially concurrent. dedicated registers may be updated in parallel as well and strings of special characters of arbitrary length accommodated by a character palette skip feature under control of a flag bit to further accelerate parsing of a document.

Owner:LOCKHEED MARTIN CORP

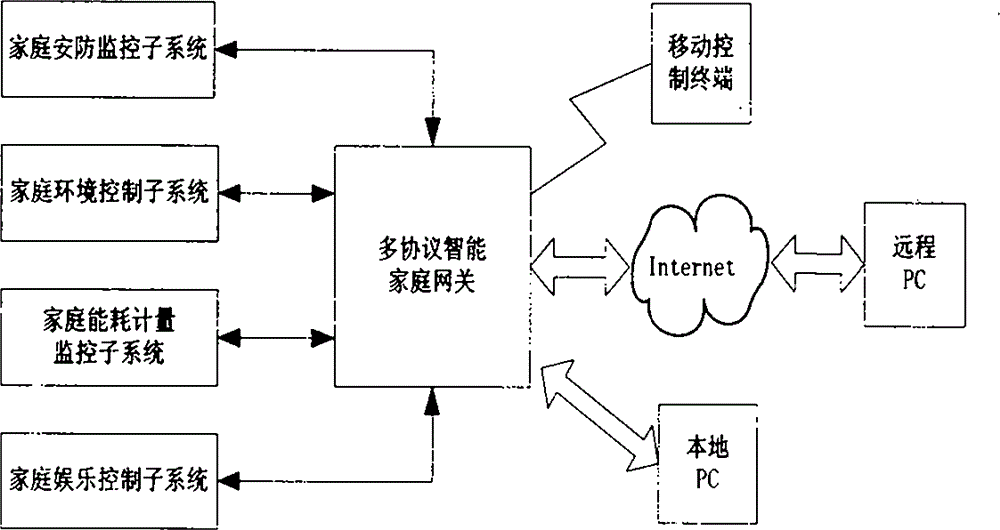

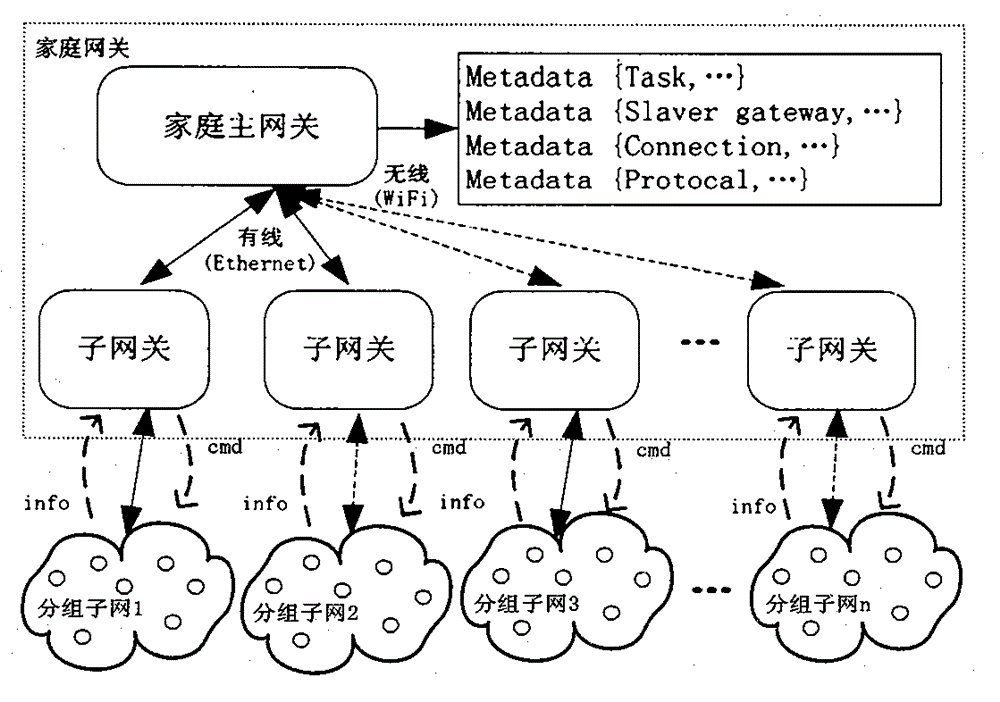

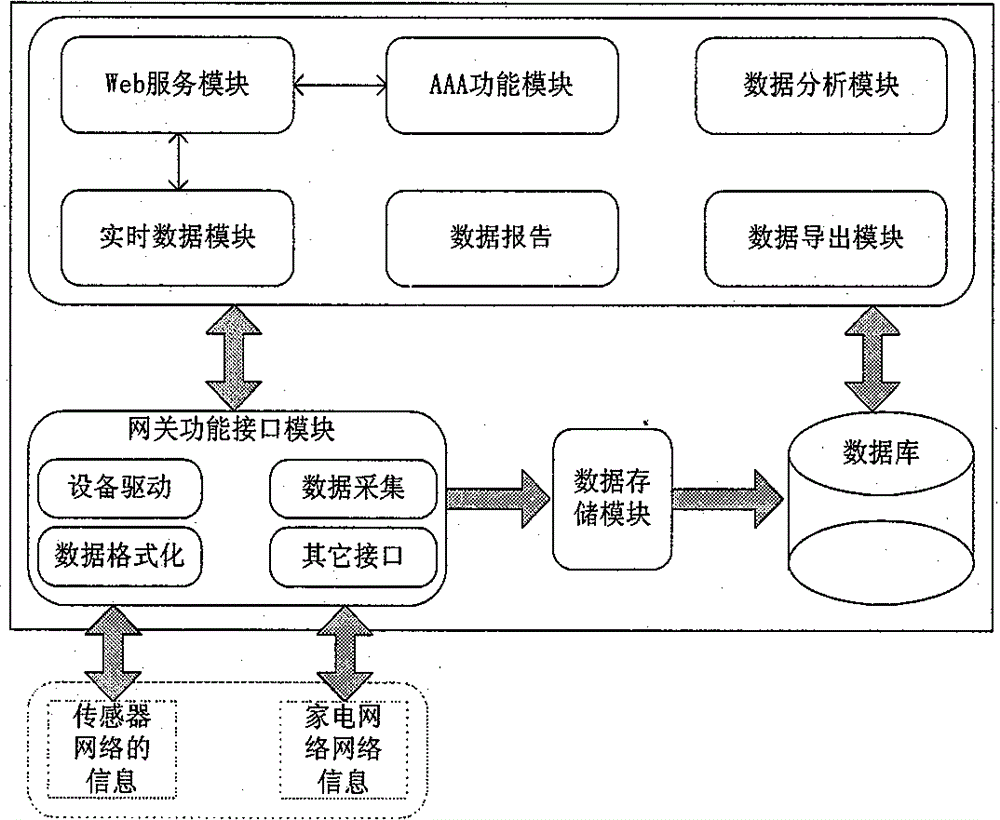

Multiprotocol intelligent household gateway apparatus and system thereof

The invention supports access and integration of multiple heterogeneous networks including a wireless network, an on-site bus, an Ethernet and the like, and provides a household gateway protocol conversion and configuration method and device, and a device description file. A configurable protocol method is mainly employed to solve the problem of conversion among multiple heterogeneous protocols. A gateway is provided with configurable protocol software, the software generates description files of various device protocols, and a protocol conversion driving file is generated through a configuration method according to protocol attributes by use of a software tool. The gateway, after loading the driving file, converts the driving file to a communication protocol which can be identified by a device and automatically maps to generate a unified TCP / IP protocol frame routing table. The description files, based on a ClassAD task description language, are used for providing a flexible and extensible heterogeneous network model to describe any services or data. The gateway, through identification and description of device information, determines the type and meaning of the information, omits information parsing, reduces the time for processing the information by the gateway, and improves the real-time performance of a system.

Owner:JIANGNAN UNIV

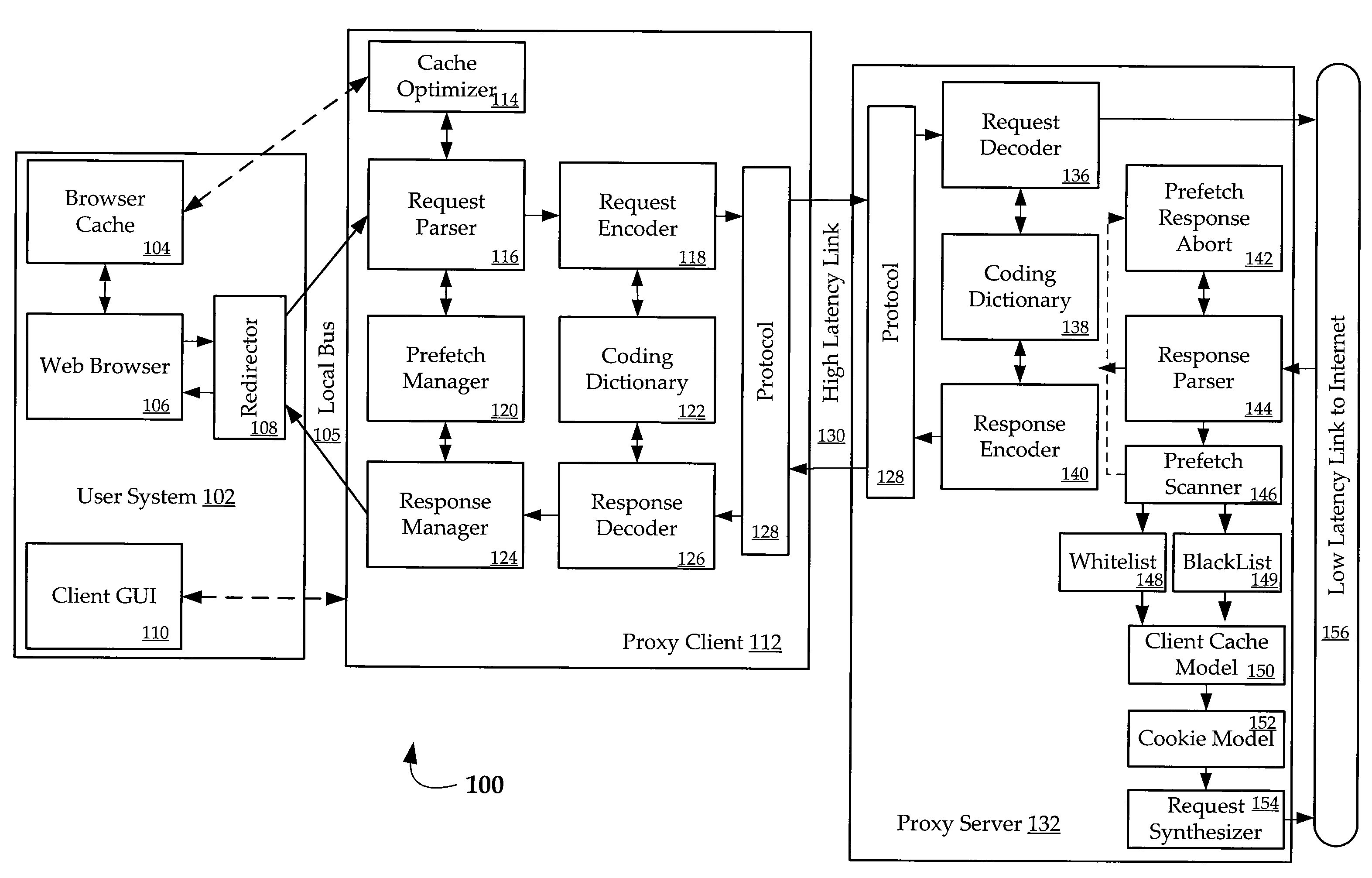

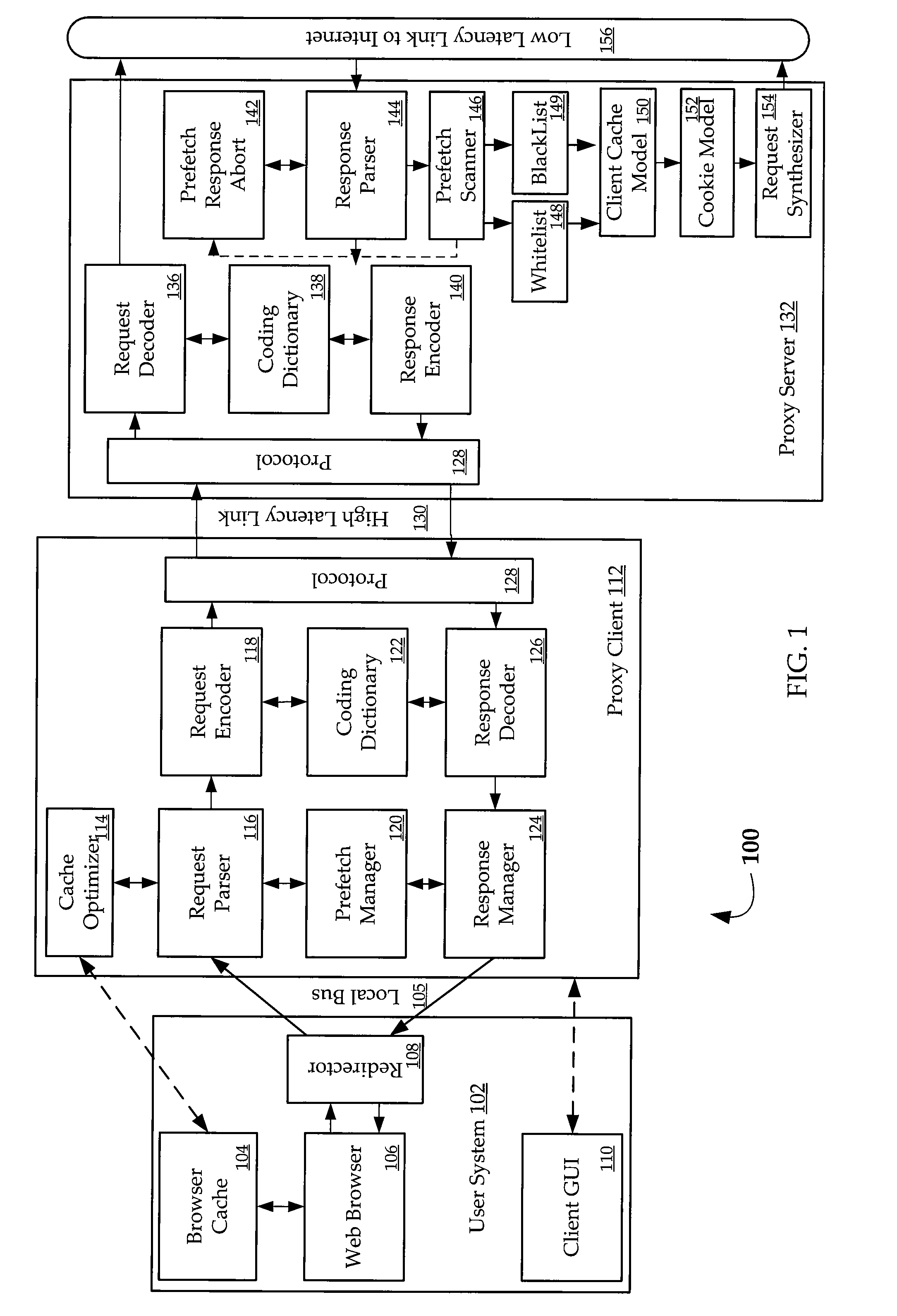

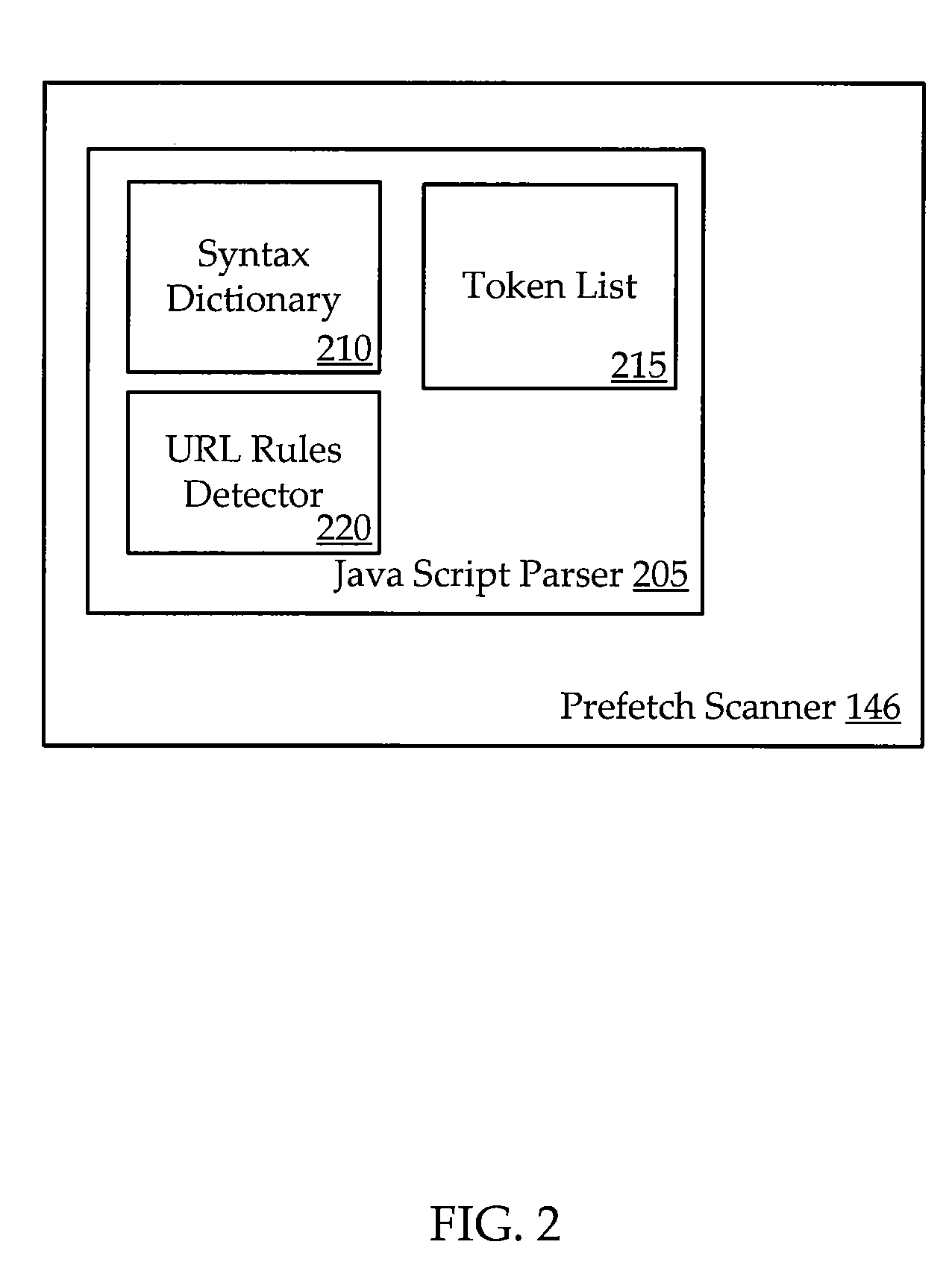

Methods and systems for JAVA script parsing

ActiveUS20090019105A1Natural language data processingMultiple digital computer combinationsUniform resource locatorParsing

The present invention relates to systems, apparatus, and methods of parsing a script within an HTML page. The method includes receiving a script object, where the script object includes text. The method further includes parsing the text of the script object for tokens and comparing the parsed tokens with a valid tokens list to determine locations within the text of the script object that include potential universal resource locators (URLs). The method includes parsing before and after the determined locations until complete URLs are constructed, and forwarding the complete URLs to a detector. The detector then determines whether the complete URLs are valid. The method then sends object retrieval requests to websites associated with the valid complete URLs.

Owner:VIASAT INC

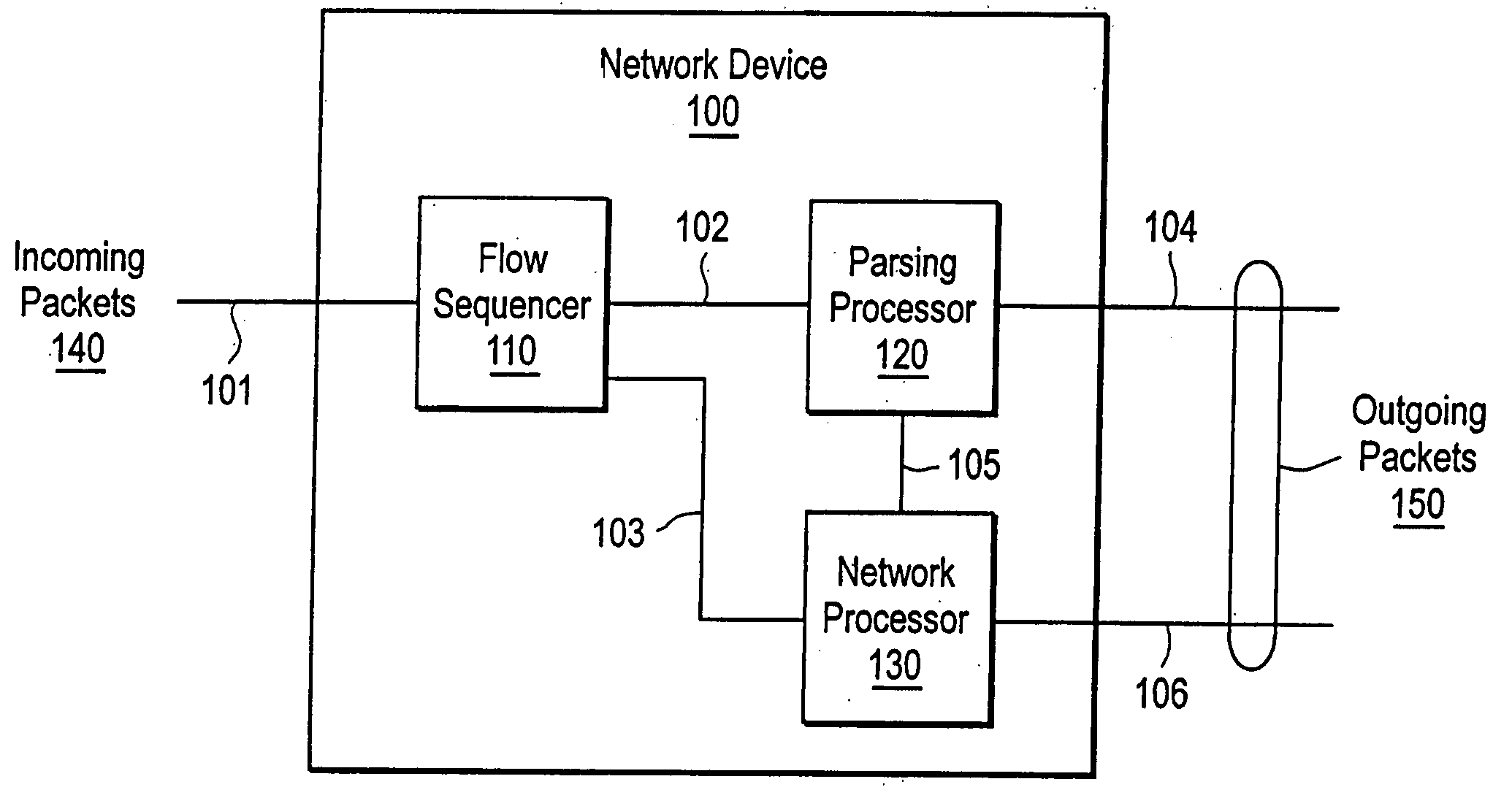

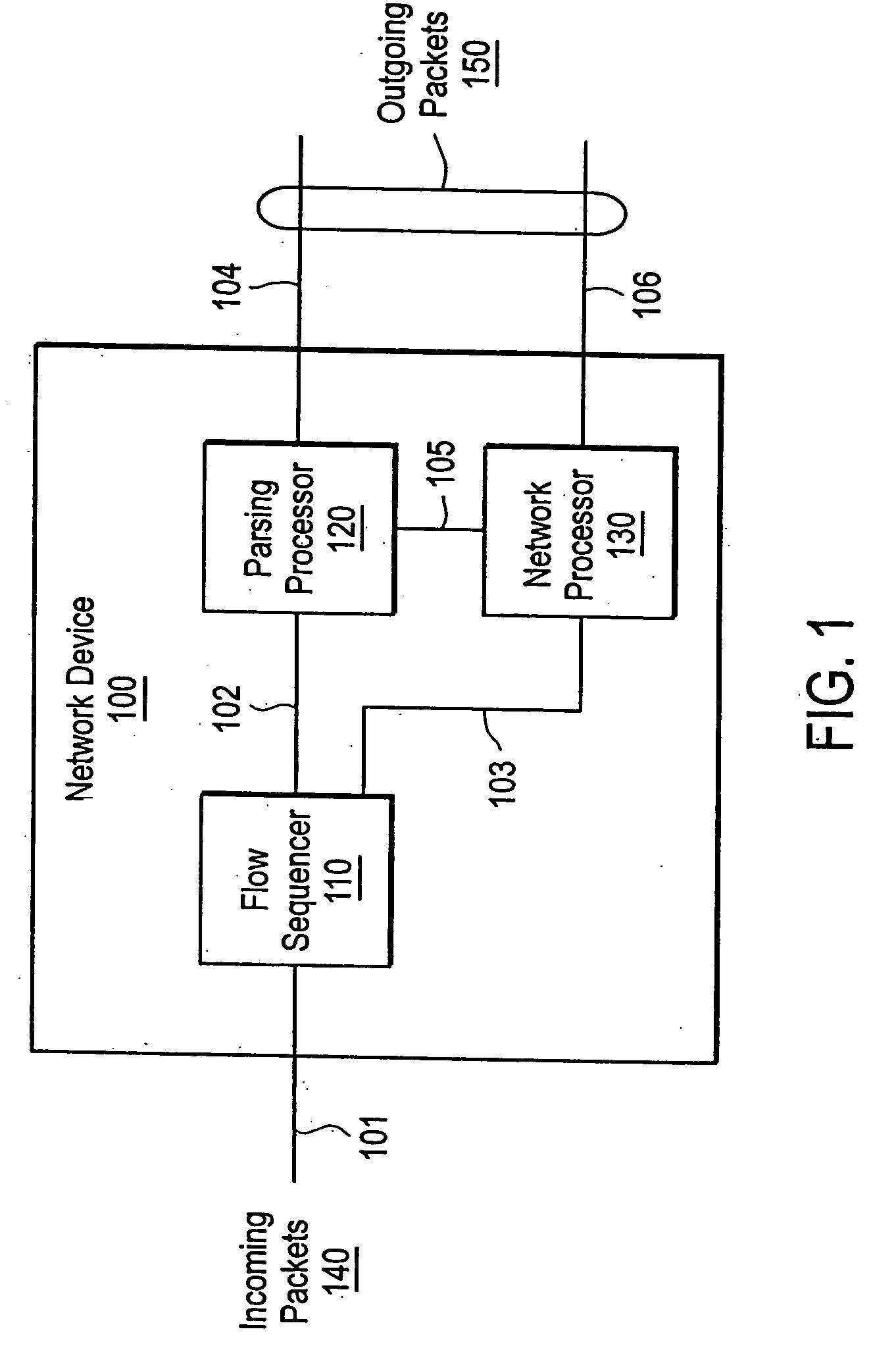

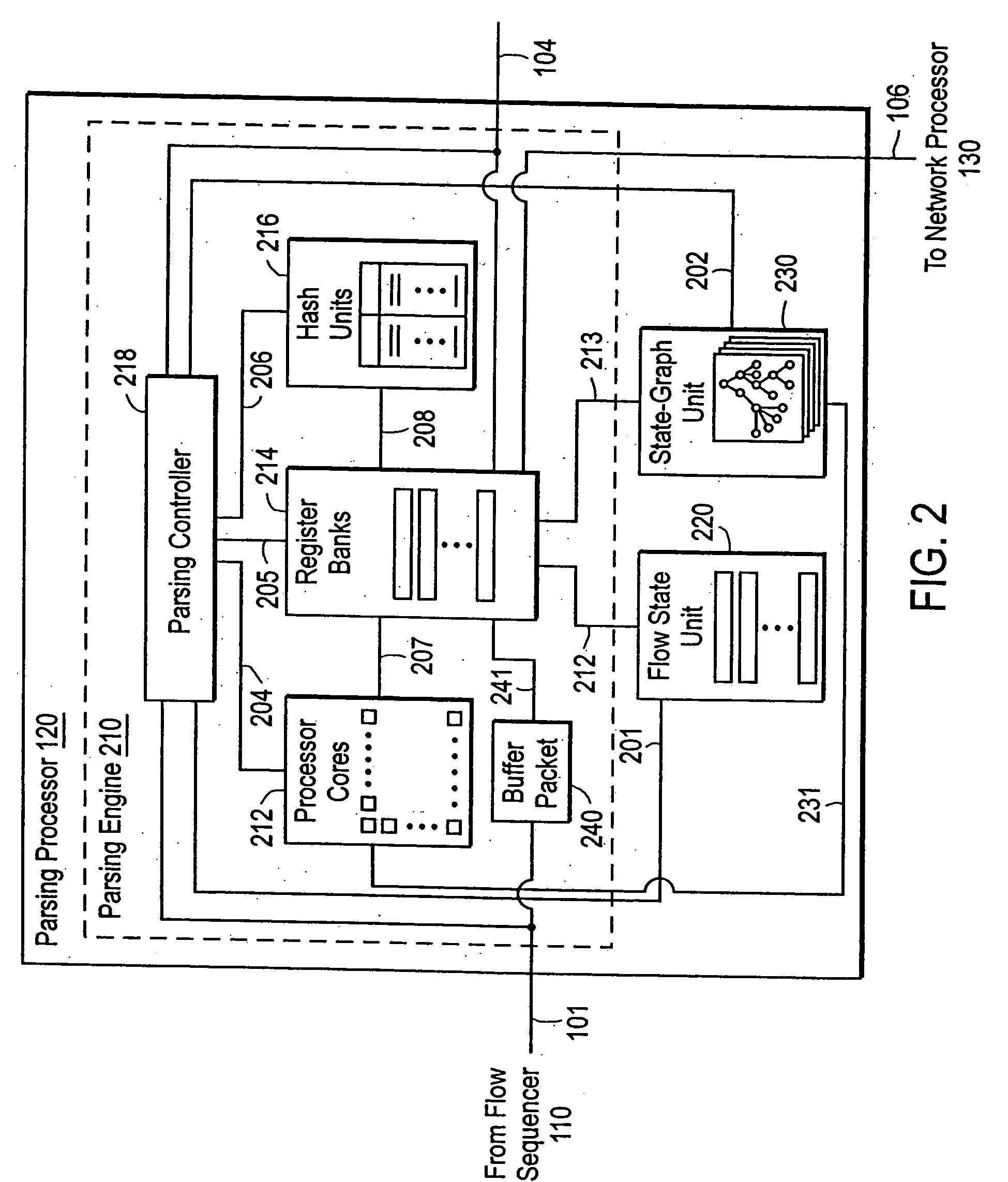

Stateful flow of network packets within a packet parsing processor

ActiveUS20050238022A1Maintain statefulnessDigital data processing detailsData switching by path configurationData packNetwork processor

The present invention provides a packet processing device and method. A parsing processor provides instruction-driven content inspection of network packets at 10-Gbps and above with a parsing engine that executes parsing instructions. A flow state unit maintains statefulness of packet flows to allow content inspection across several related network packets. A state-graph unit traces -state-graph nodes to keyword indications and / or parsing instructions. The parsing instructions can be derived from a high-level application to emulate user-friendly parsing logic. The parsing processor sends parsed packets to a network processor unit for further processing.

Owner:CISCO TECH INC

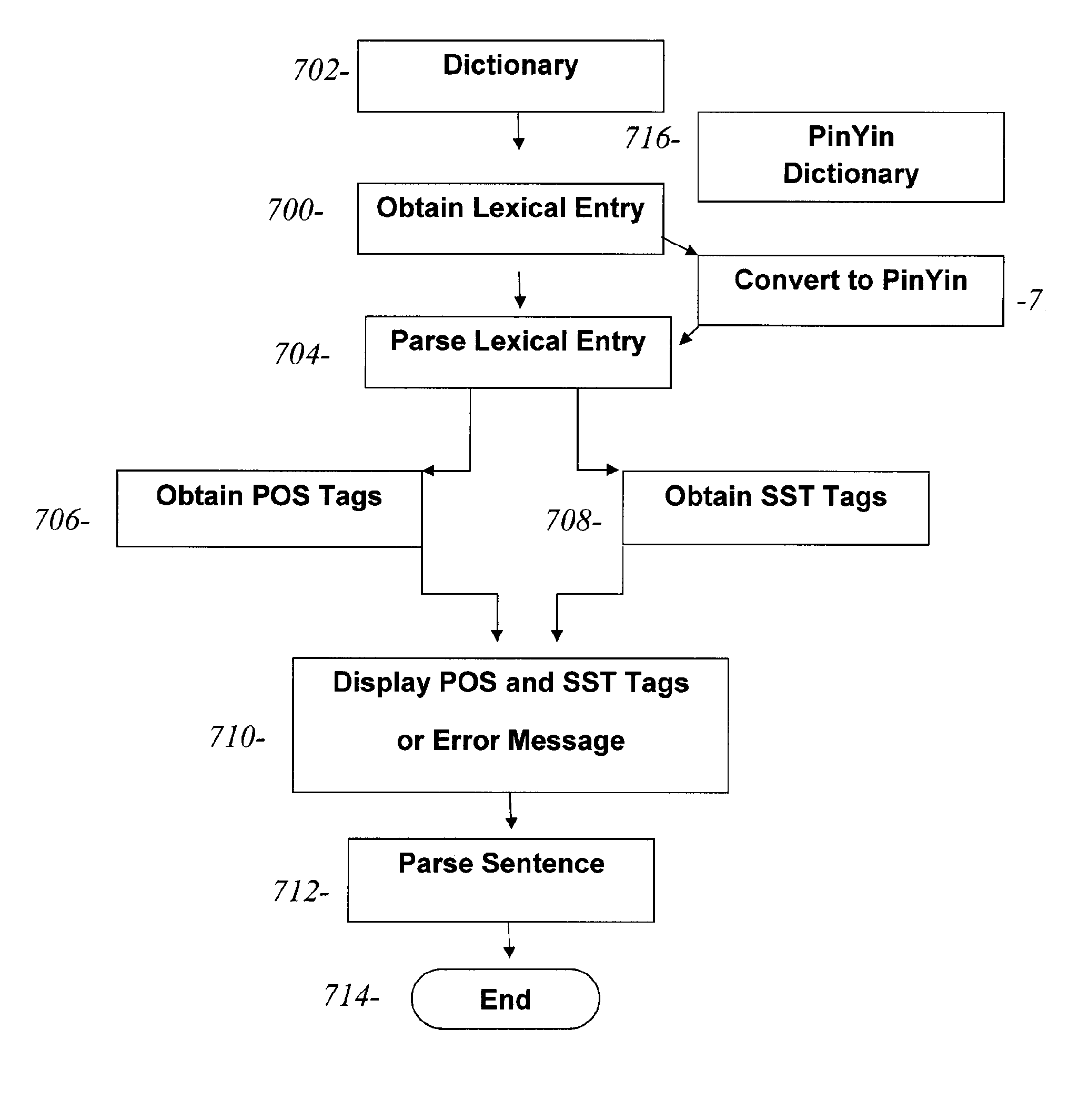

Natural language processor

InactiveUS20150039295A1Address limitationsNatural language translationSpecial data processing applicationsPart of speechParsing

Disclosed is a method for converting a plurality of words or sign language gestures into one or more sentences. The method involves the steps of: obtaining a plurality of words; assigning a part of speech tag to each of said words; assigning a sentence structure tag to said plurality of words; and parsing said words into one or more sentences based on a predefined sentence structure. The method can be implemented by a computer to provide a translator that more accurately reflects the natural language of the original text.

Owner:SOSCHEN ALONA

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com