Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

3158 results about "Invoice" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

An invoice, bill or tab is a commercial document issued by a seller to a buyer, relating to a sale transaction and indicating the products, quantities, and agreed prices for products or services the seller had provided the buyer.

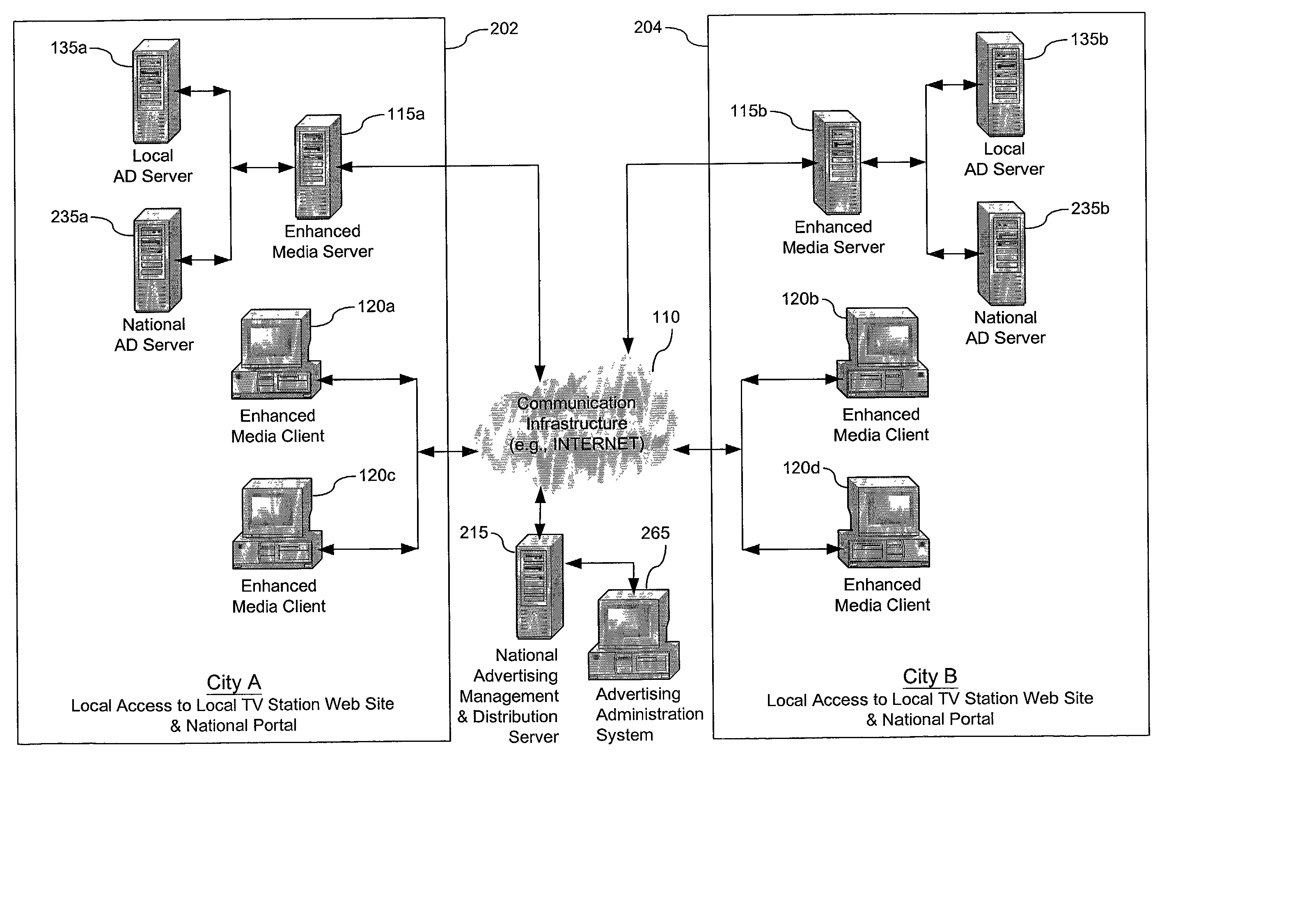

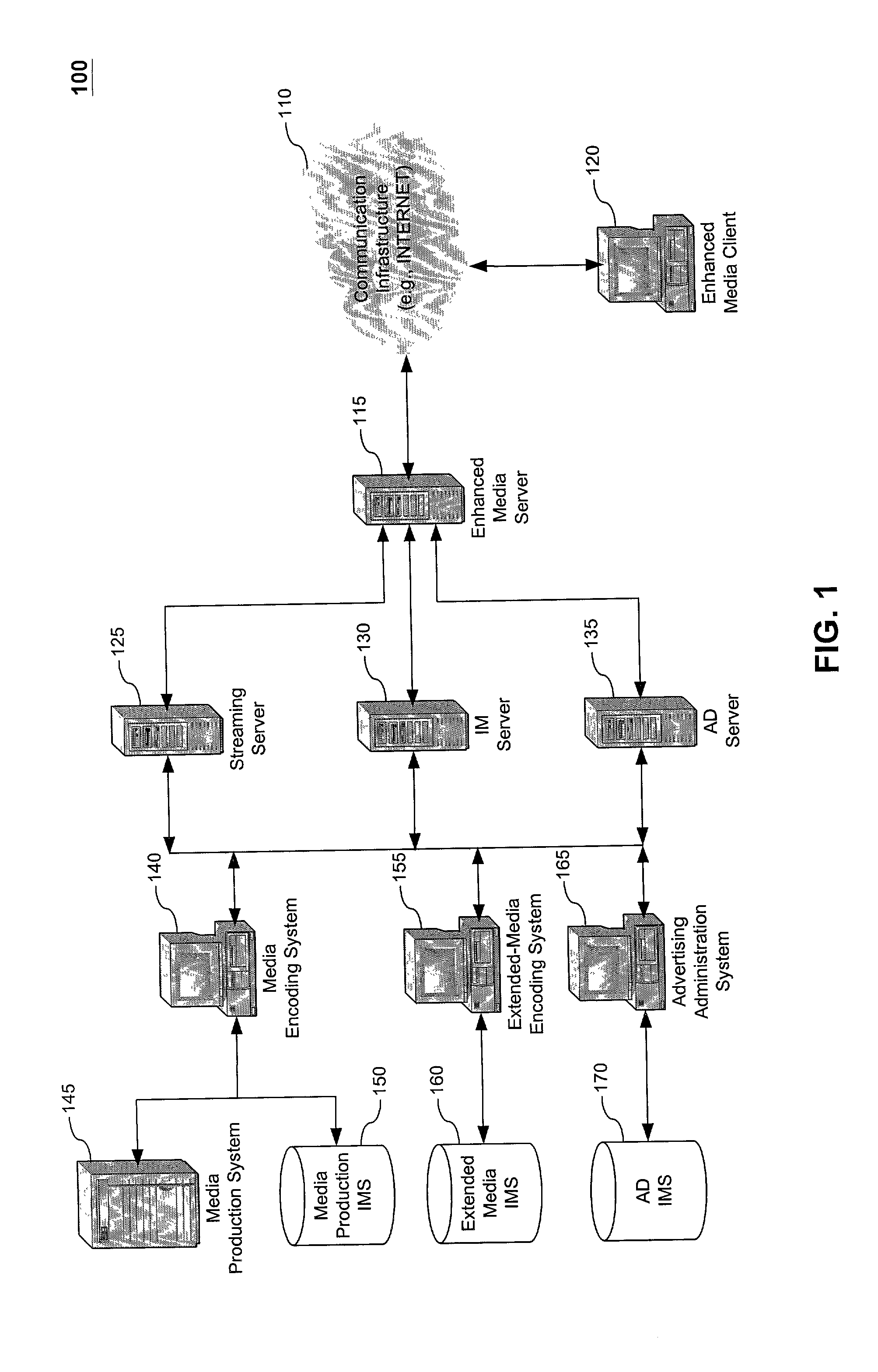

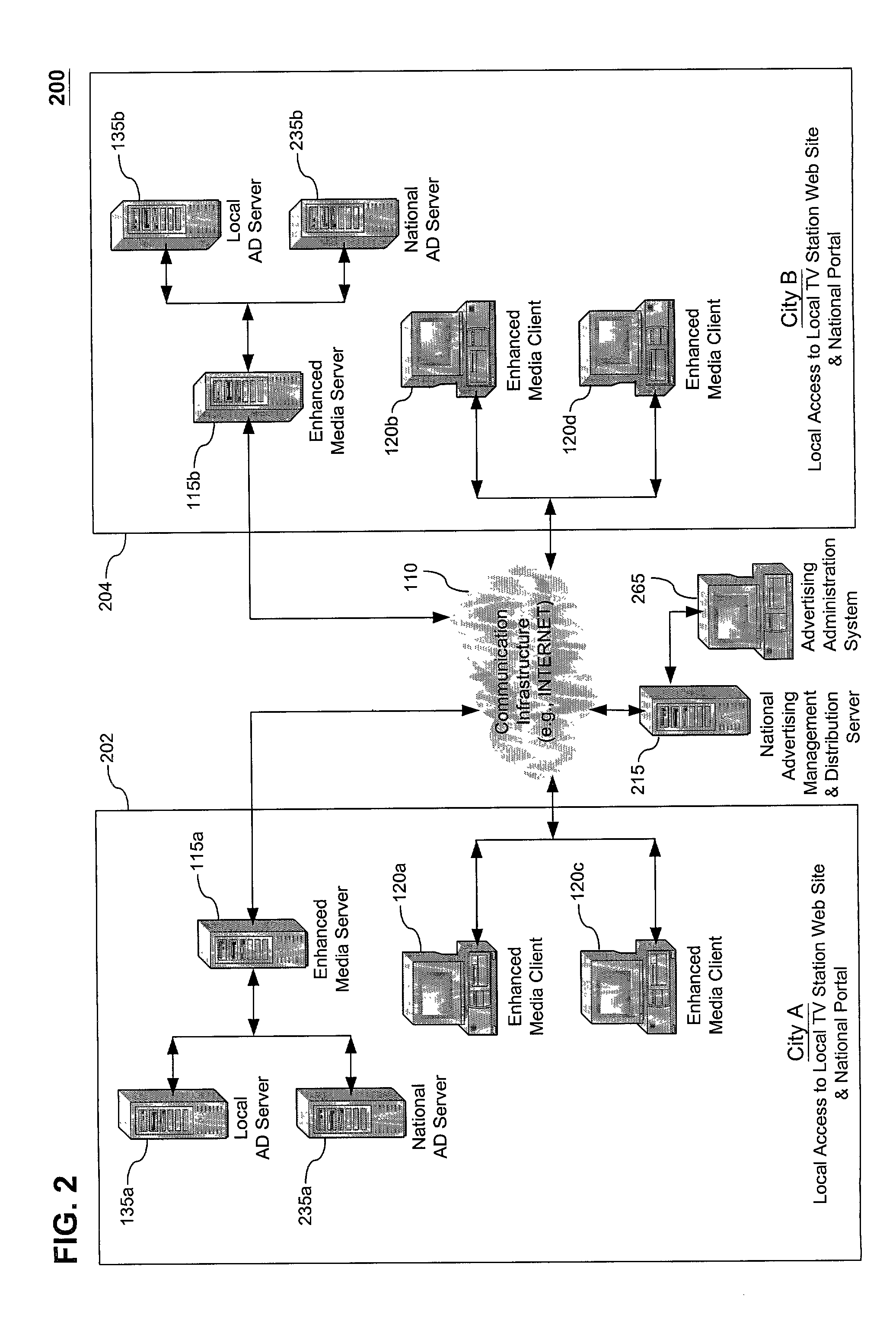

Method, system and computer program product for producing and distributing enhanced media downstreams

InactiveUS20020053078A1Fair and equitableEasy retrievalTelevision system detailsRecord information storageThe InternetTelevision station

A multimedia production and distribution system collects or assembles a media production (such as, a news program, television programming, or radio broadcast) from a variety of sources, including television stations and other media hosting facilities. The media production is categorized and indexed for retrieval and distribution across a wired or wireless network, such as the Internet, to any client, such as a personal computer, television, or personal digital assistant. A user can operate the client to display and interact with the media production, or select various options to customize the transmission or request a standard program. Alternatively, the user can establish a template to generate the media production automatically based on personal preferences. The media production is displayed on the client with various media enhancements to add value to the media production. Such enhancements include graphics, extended play segments, opinion research, and URLs. The enhancements also include advertisements, such as commercials, active banners, and sponsorship buttons. An advertisement reporting system monitors the sale and distribution of advertisements within the network. The advertisements are priced according to factors that measure the likelihood of an advertisement actually being presented or viewed by users most likely to purchase the advertised item or service. The advertisement reporting system also collects metrics to invoice and apportion income derived from the advertisements among the network participants, including a portal host and / or producer of the content.

Owner:PARKER VISION INC

Electronic menu document creator in a virtual financial environment

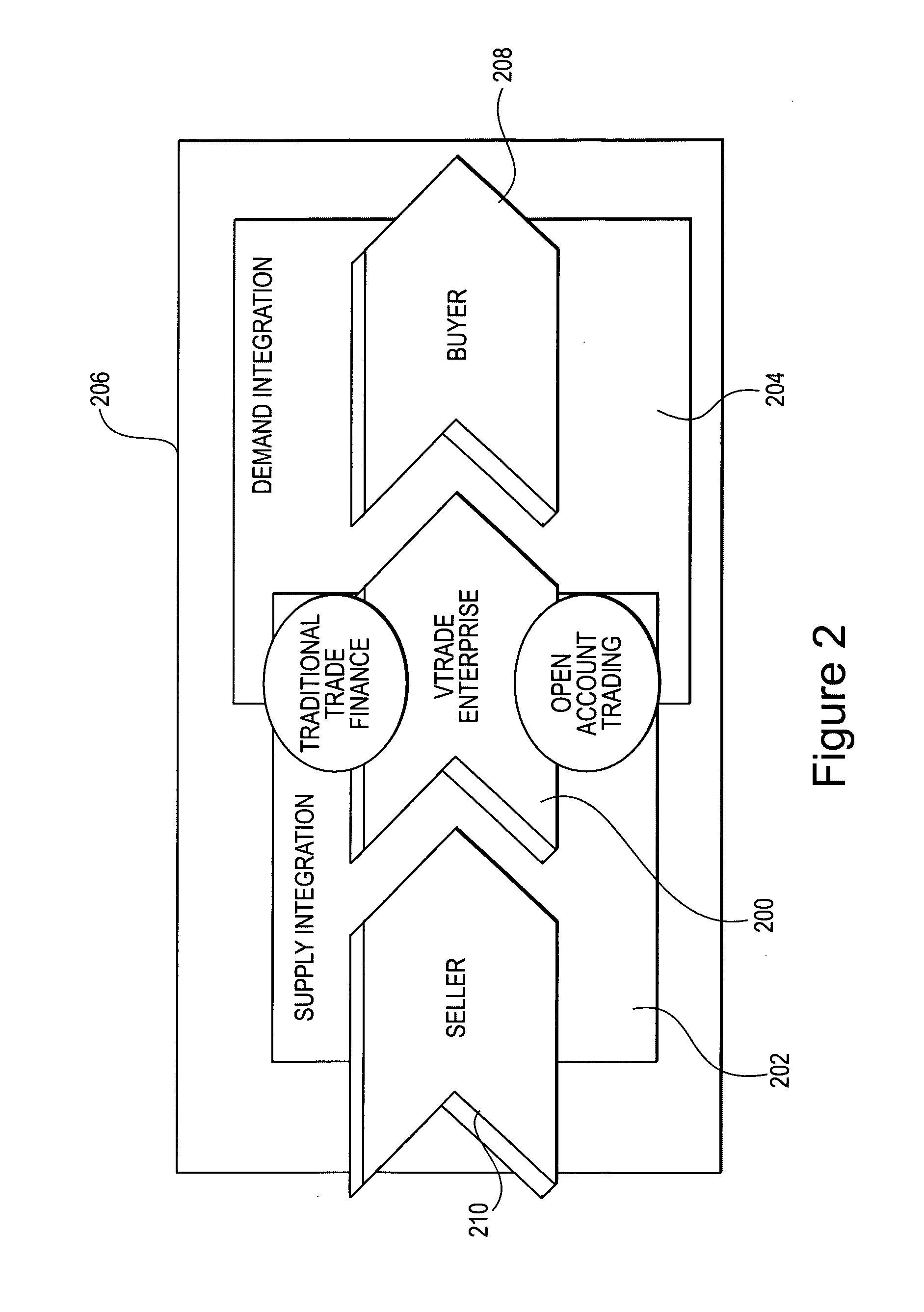

The disclosure provides for creating a finalized document relating to a transaction. A buyer selects documents associated with a proposed transaction and indicates trade terms of an agreement relating to the documents selected. The trade terms are presented to a seller on an electronic form via an electronic document platform. The electronic form includes a combined purchase order proforma invoice, a transportation document, and a shipping document. The seller can amend the trade terms on the form, and each amendment creates a new version of the form. Negotiations of the trade terms between the buyer and the seller are conducted electronically and the negotiated fonn detailing the negotiation of the trade terms is generated and displayed electronically, also. A compliance check is performed and is triggered in response to a digital signature of the form. Payment is initiated to the seller after a verification of credit of the buyer.

Owner:ACCENTURE GLOBAL SERVICES LTD

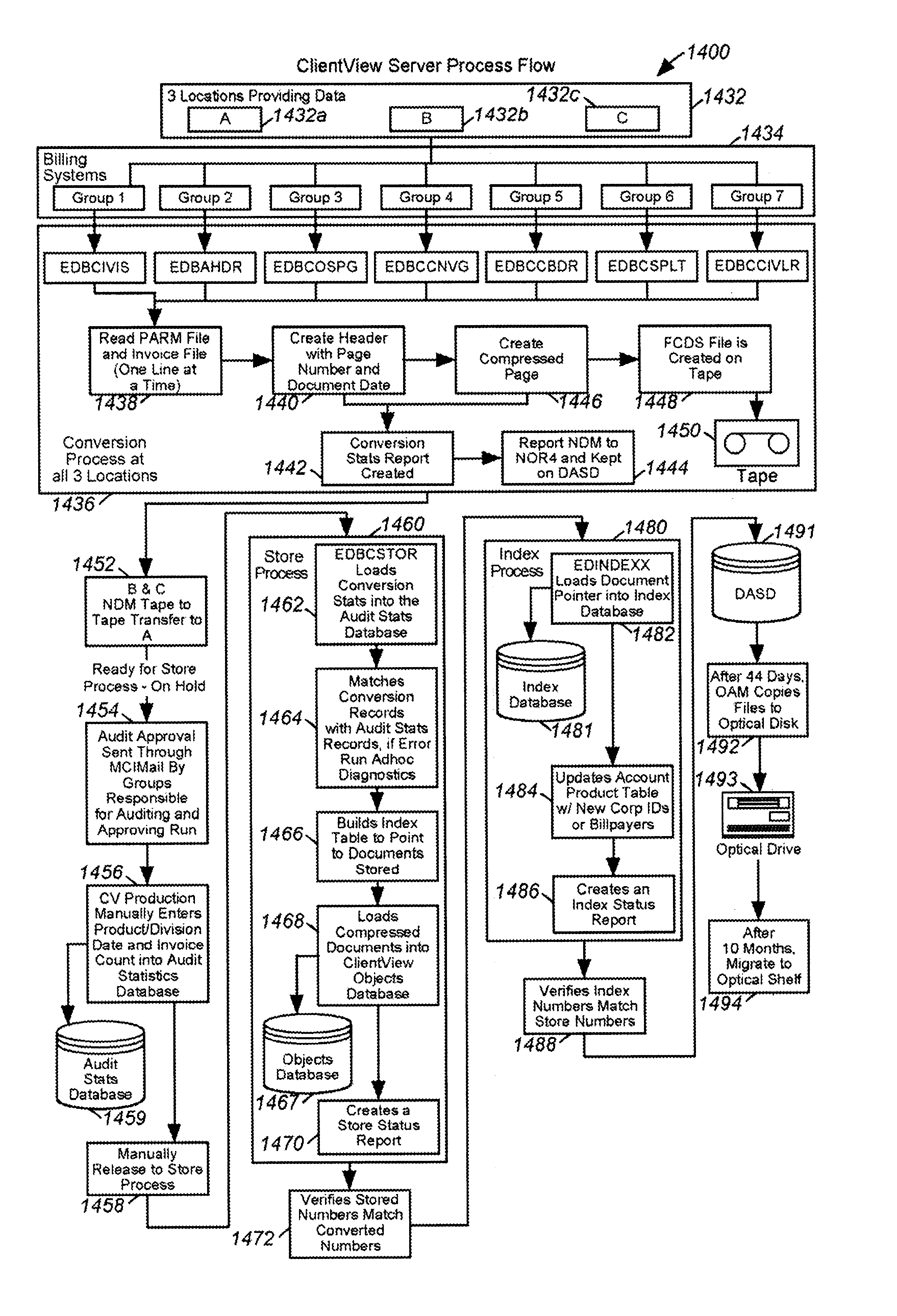

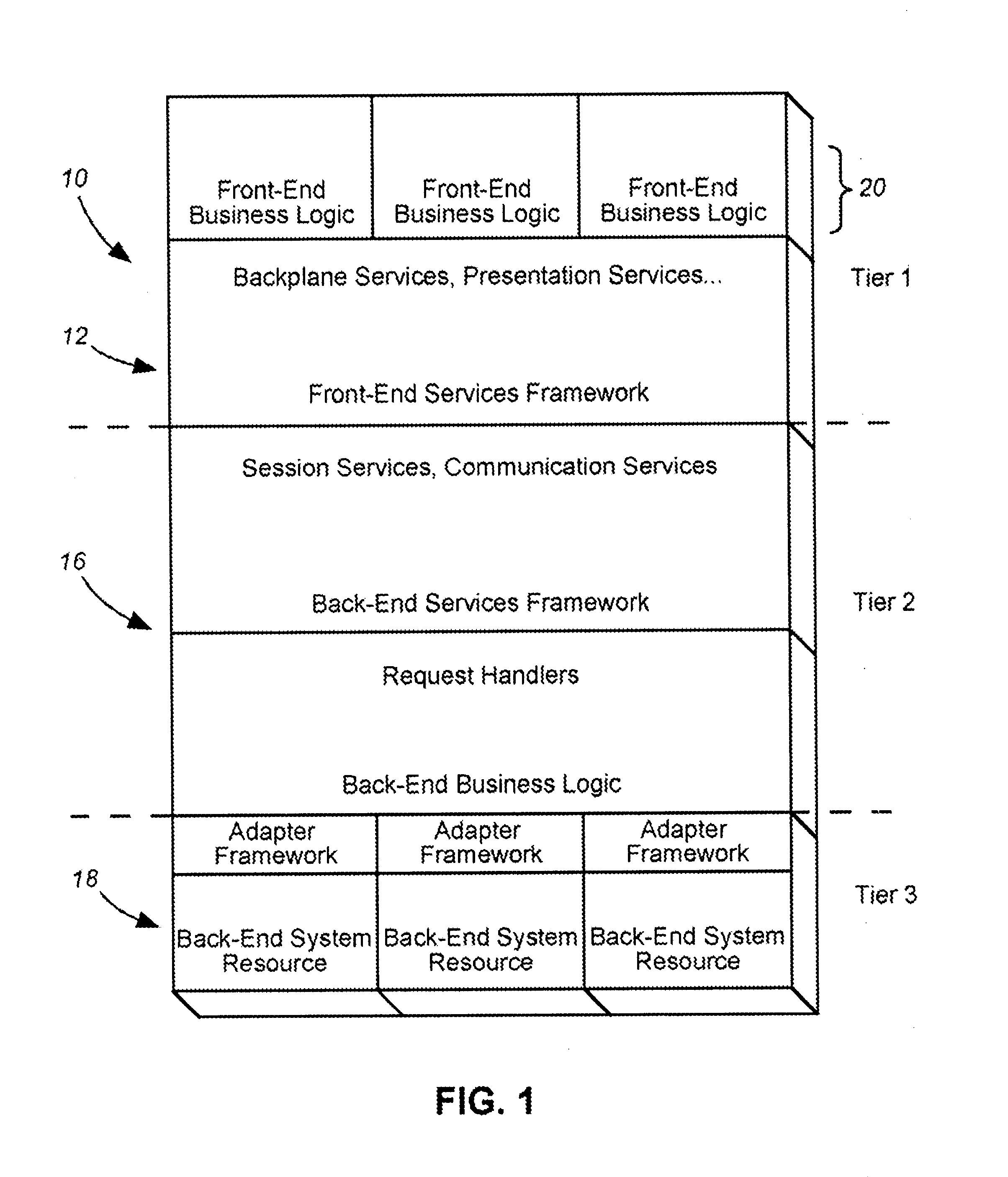

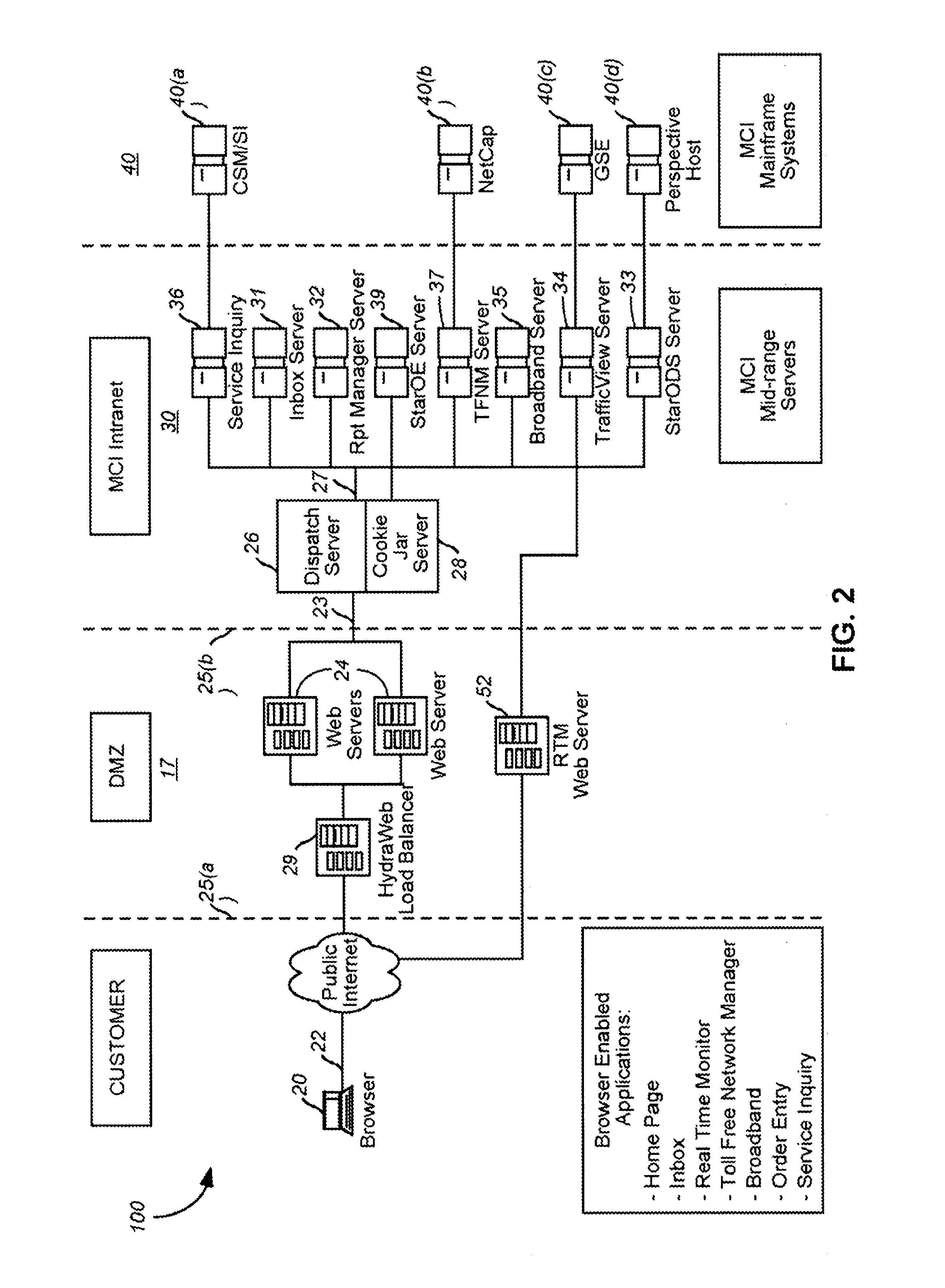

Integrated systems for providing communications network management services and interactive generating invoice documents

InactiveUS7225249B1Easy and convenient accessTelephonic communicationCathode-ray tube indicatorsWeb serviceInvoice

A integrated customer interface for providing telecommunications management to a customer at a browser involves a web server and a client application. The web server manages a client session supports communication of request messages received from the browser to a network management resource. The client application is integrated for use within the browser, downloadable from the web server in accordance with a predetermined customer entitlement, and programmed to be in interactive communications with the network management resource.

Owner:VERIZON PATENT & LICENSING INC

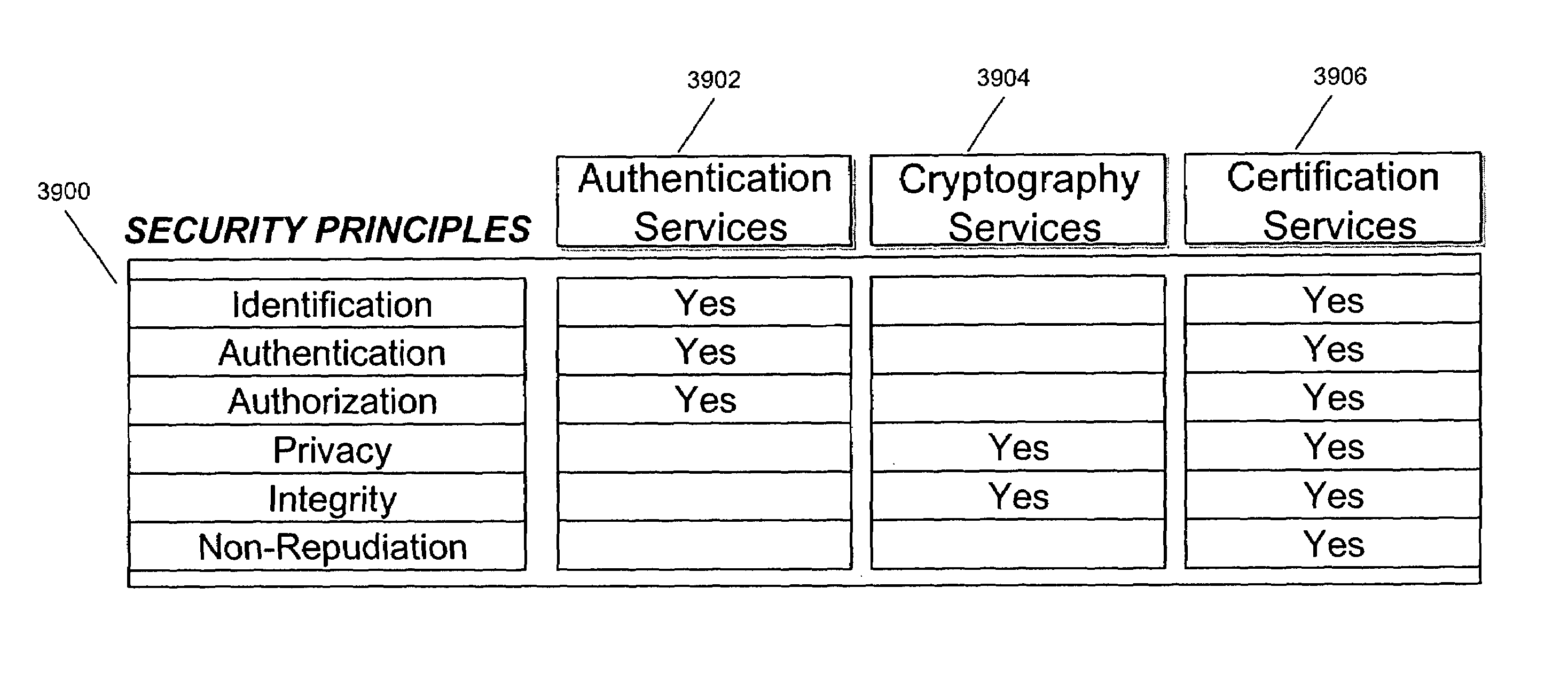

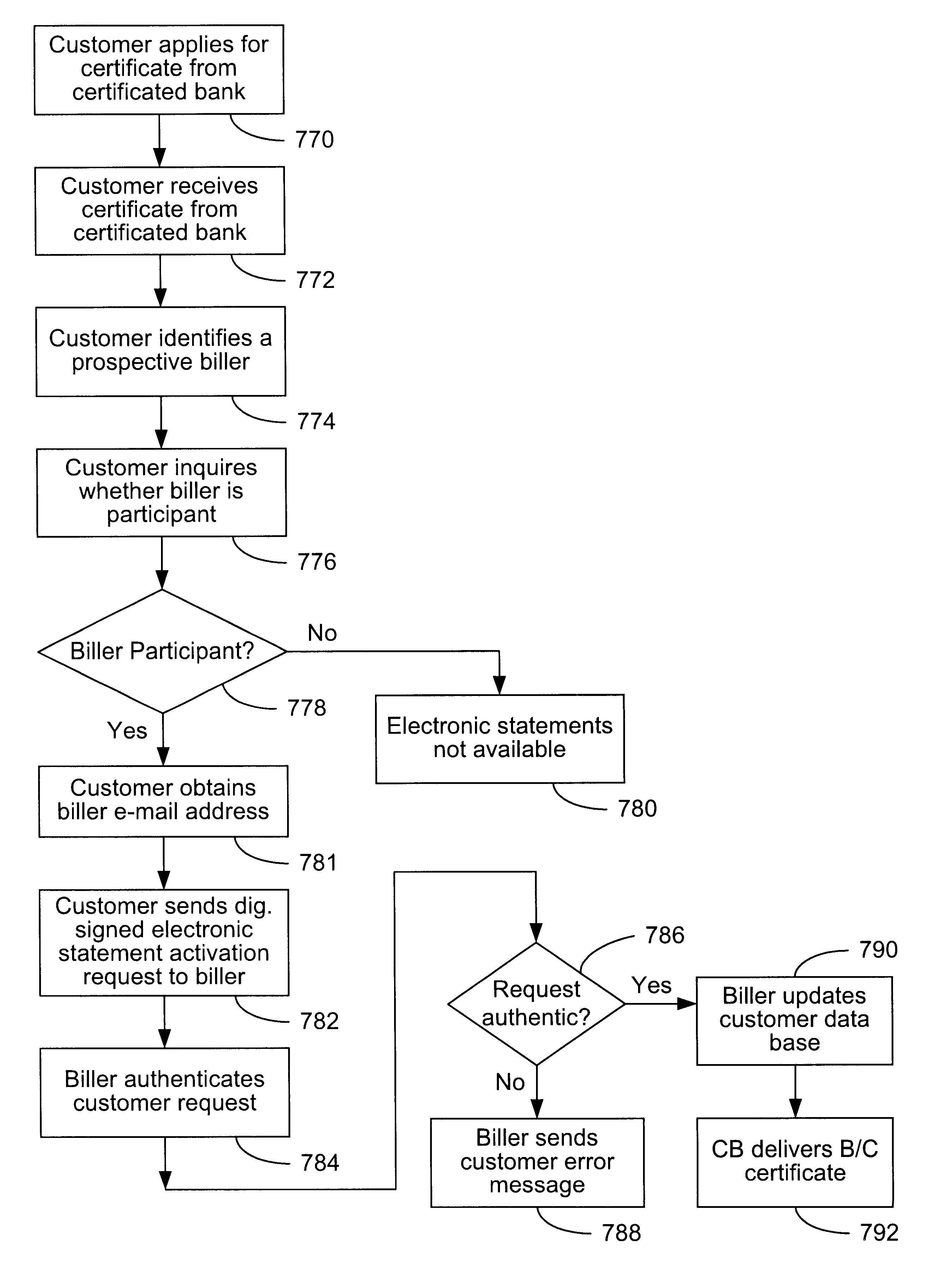

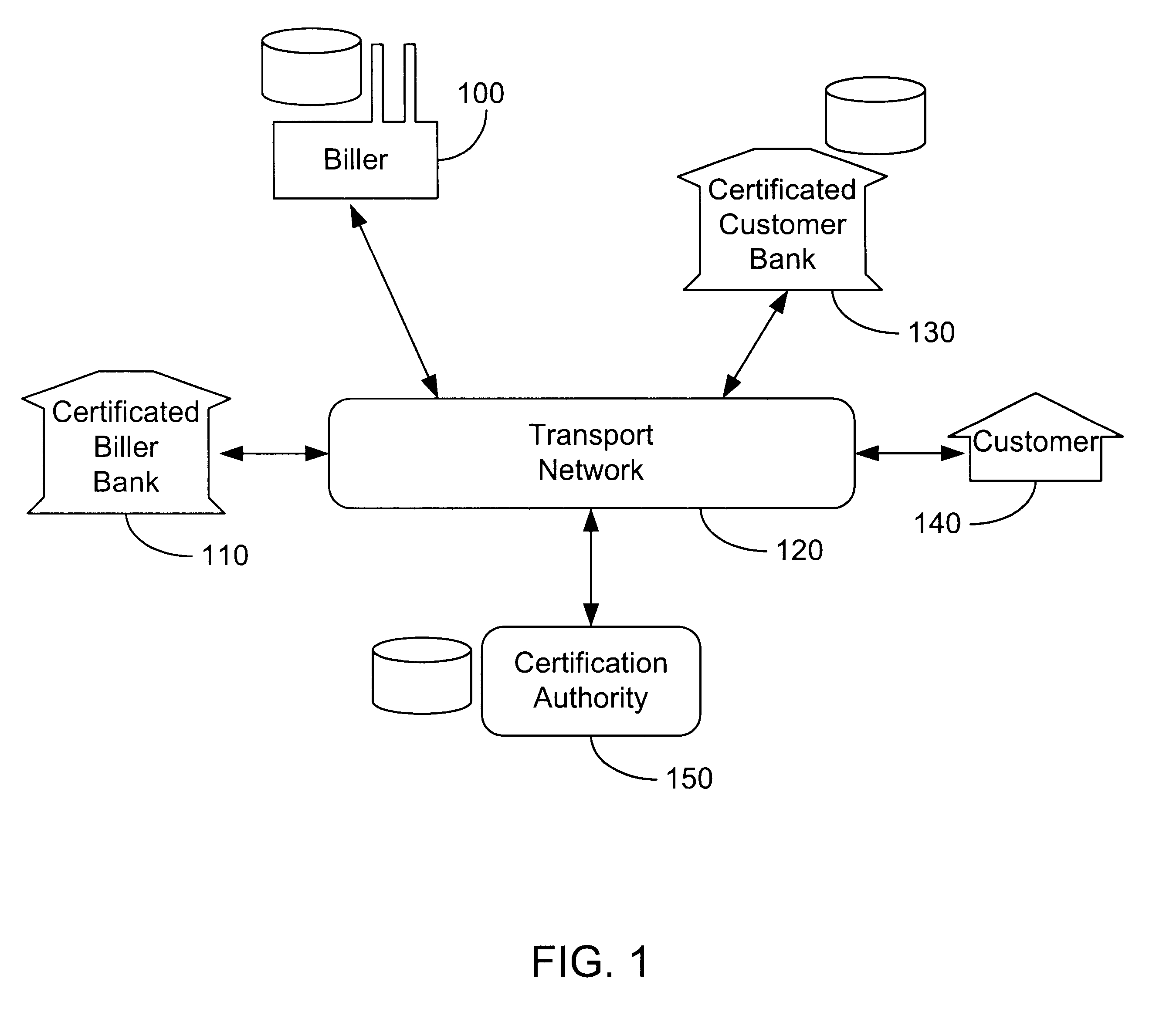

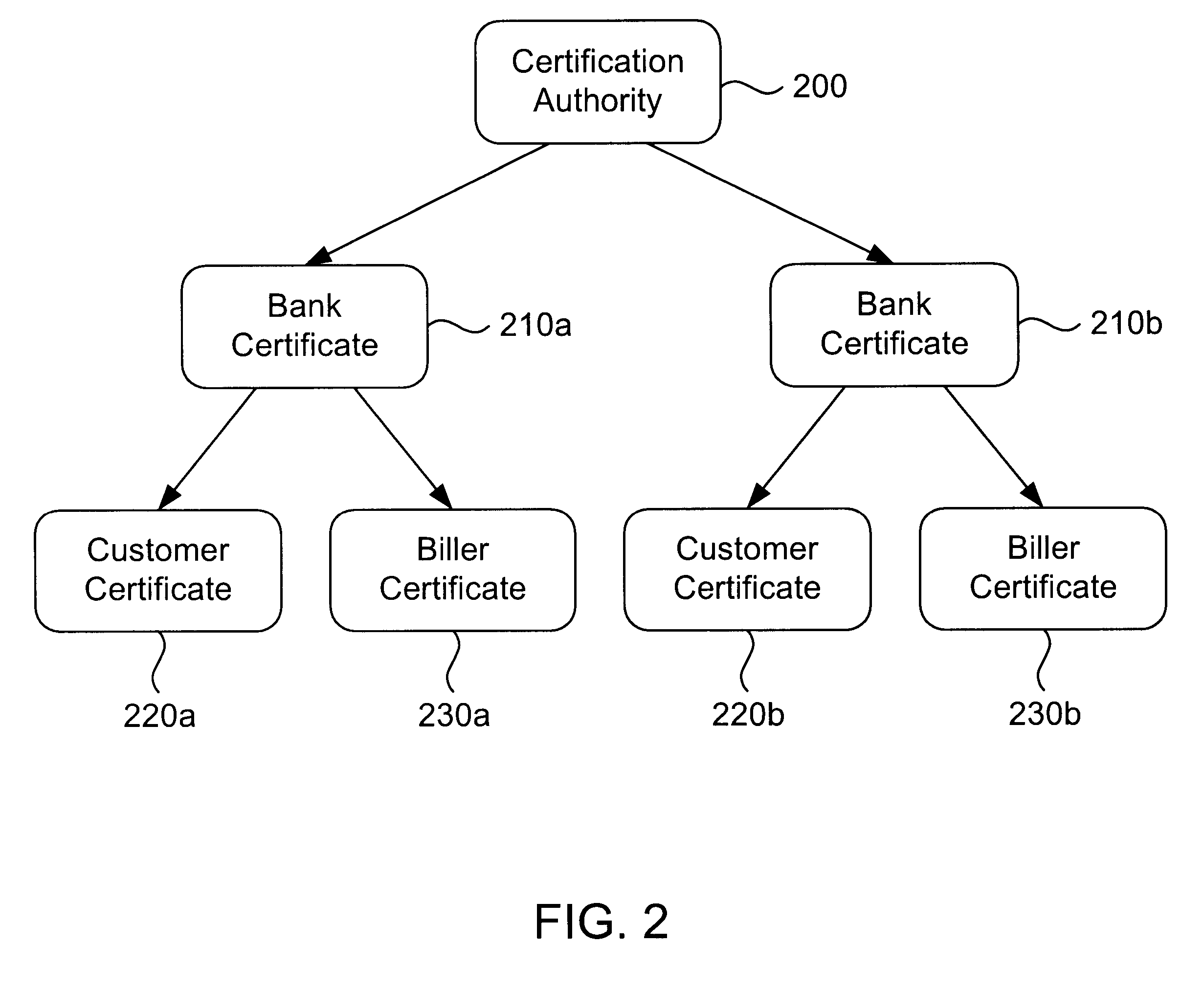

Secure interactive electronic account statement delivery system

InactiveUS6285991B1Good flexibilityBilling is thereby complicatedFinanceUser identity/authority verificationDigital dataNetwork communication

The present invention consists of a secure interactive electronic account statement delivery system suitable for use over open networks such as the Internet. The invention utilizes a certification hierarchy to insure that electronic bills, invoices, and other account statements can be securely sent over open networks. The participants in the system are a certification authority, certificated banks, billers, and customers. The certification authority grants digital certificates to the certificated banks, which in turn grant digital certificates to billers and customers. Digital certificates form the basis for encryption and authentication of network communications, using public and private keys. The certificates associate a customer and biller with a certificated bank and with the electronic billing system, much like payment cards associate a customer with a payment card issuer and a particular payment card system. Digital signatures are used for authentication and non-repudiation. The certificates may be stored as digital data on storage media of a customer's or biller's computer system, or may be contained in integrated circuit or chip cards physically issued to billers and customers. The electronic bill itself may be a simple text message containing the equivalent of summary information for the bill, or may be more elaborate. In one embodiment of the invention, the electronic bill contains a number of embedded links, for example an embedded URL of a biller's world wide web server that allows the customer to interactively bring up detailed billing information by activating the link. The e-mail message may also include links to third party websites.

Owner:VISA INT SERVICE ASSOC

Electronic multiparty accounts receivable and accounts payable system

InactiveUS7206768B1Facilitating collection and trackingFacilitate communicationComplete banking machinesFinanceAccounts payableInvoice

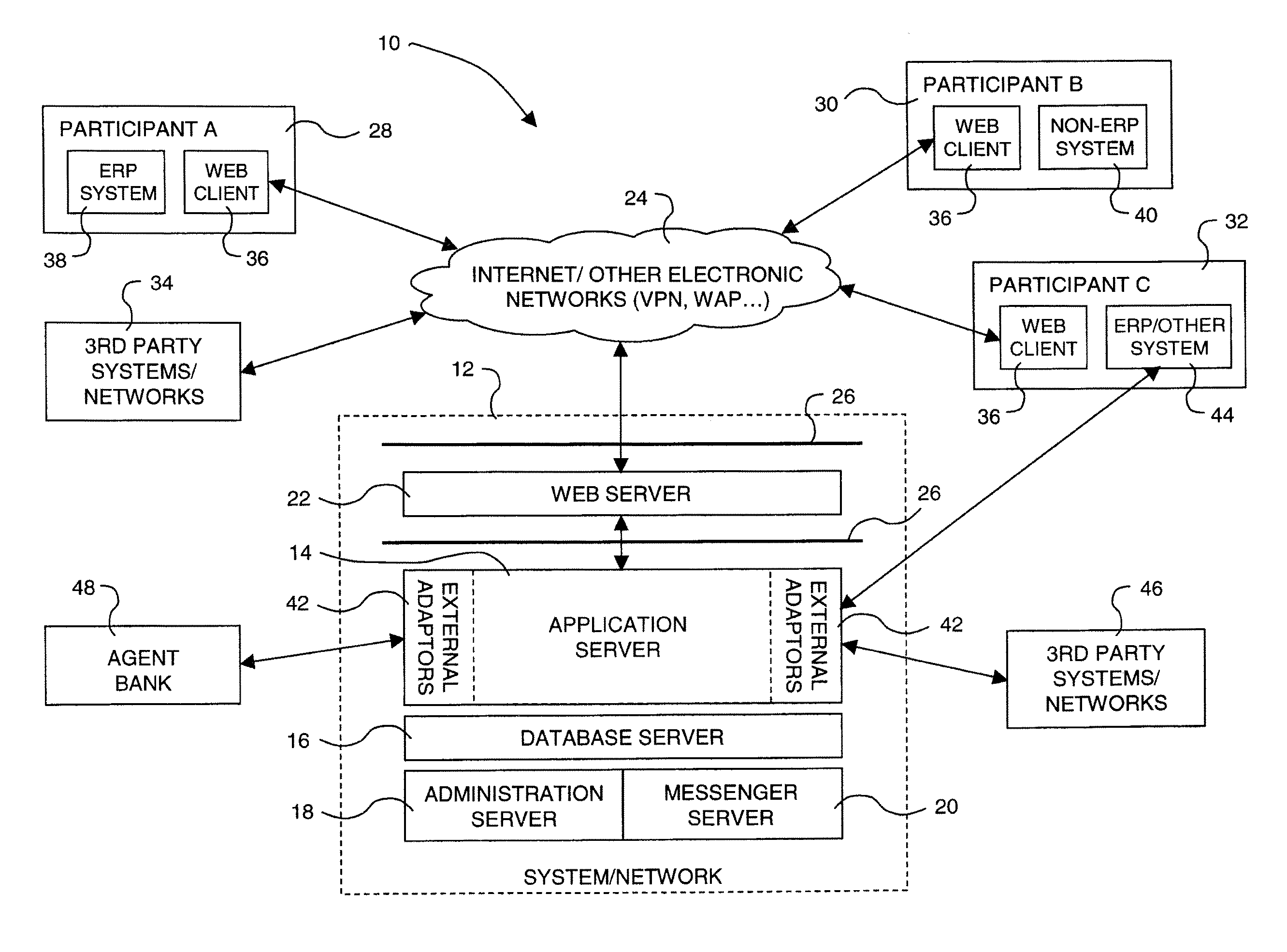

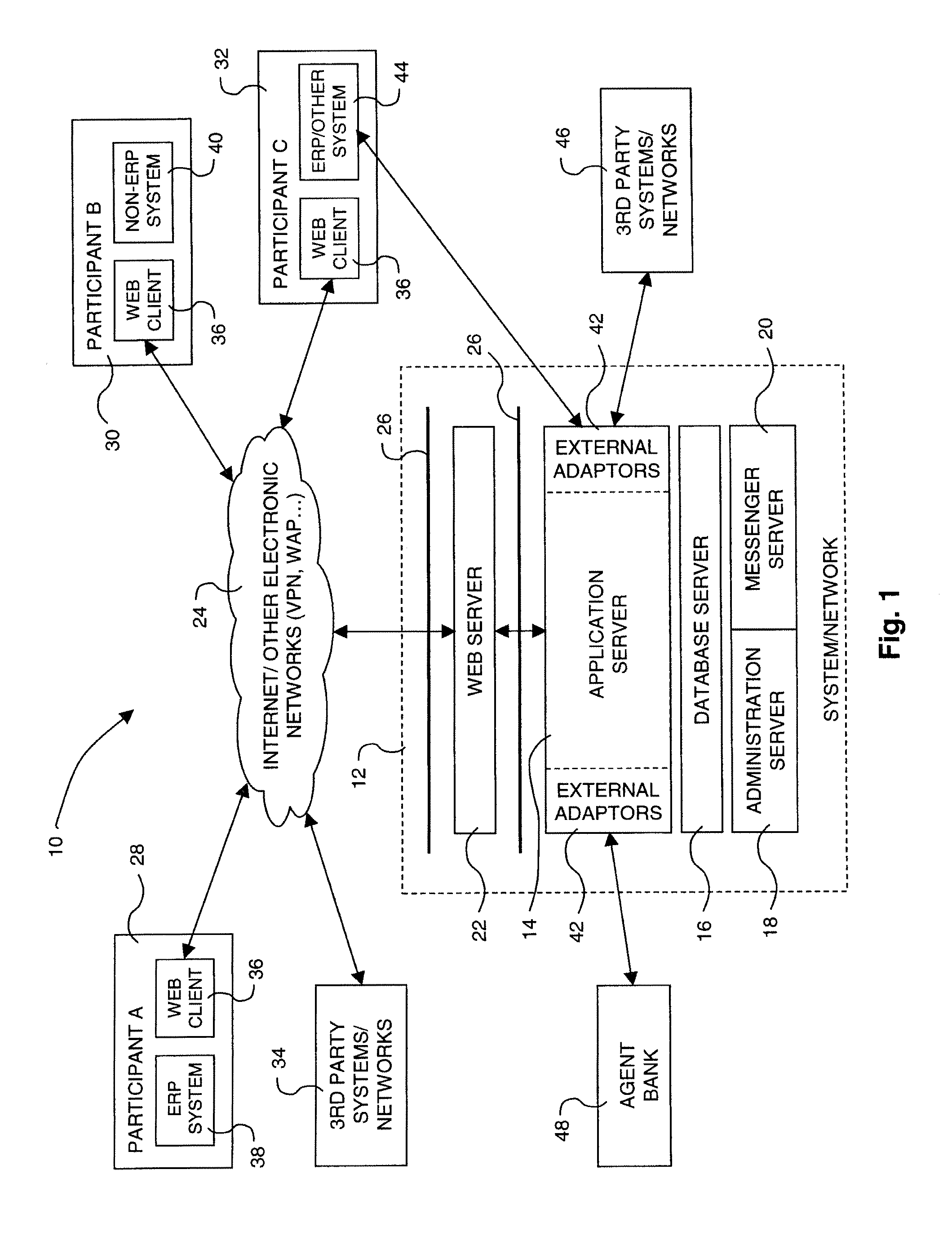

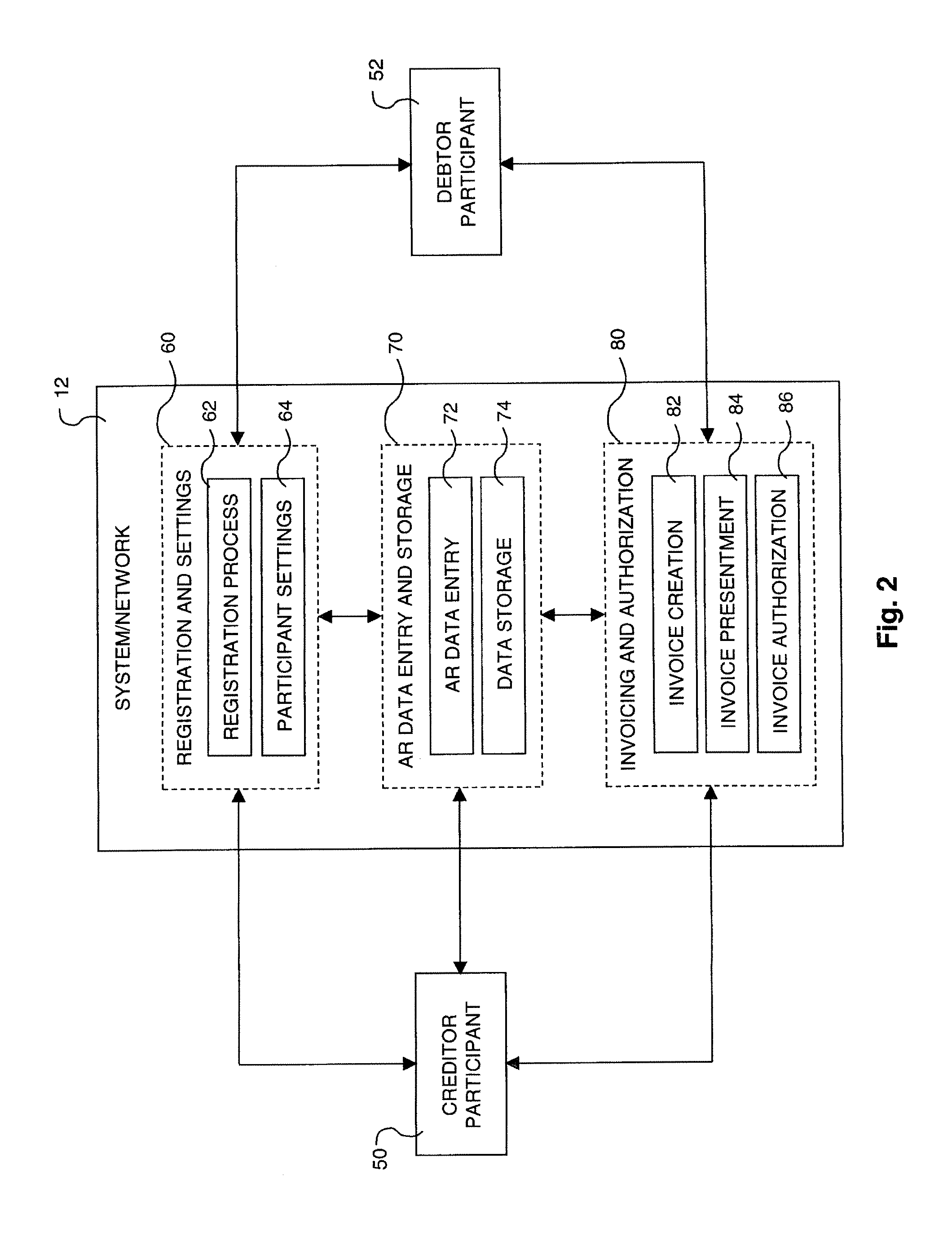

The invention concerns a multiparty accounts receivable and accounts payable system that allows business trading partners to use a single, shared system for both accounts receivable and accounts payable management. The system of the invention forms an electronic “bridge” between a plurality of business trading partners for purposes of invoicing, dispute resolution, financing, and settlement of single and multiple currency debts. As the invoicing and settlement activities of the participants are funneled through a common system, the system allows a participant to aggregate all debts owed to other participants, aggregate all debts owed by the other participants, and net debts owed to other participants with debts owed by these participants. After aggregation and netting, the participant issues a single payment to settle numerous accounts payable items, and receives a single payment that settles numerous accounts receivable items. The system allows participants to use the substantial amount of financial and cash flow information captured by the system to borrow more efficiently by permitting lenders to view this information. Furthermore, the system provides a confirmation process to convert existing debt obligations into a new, independent payment obligation due on a date certain and free of any defenses to the underlying contract. The confirmed debt obligations provide a better source of working capital for the participants, or can be converted into electronic promissory notes. The system provides an electronic exchange for electronic promissory notes, allowing participants to raise working capital in various ways, for example, by selling them.

Owner:JPMORGAN CHASE BANK NA +1

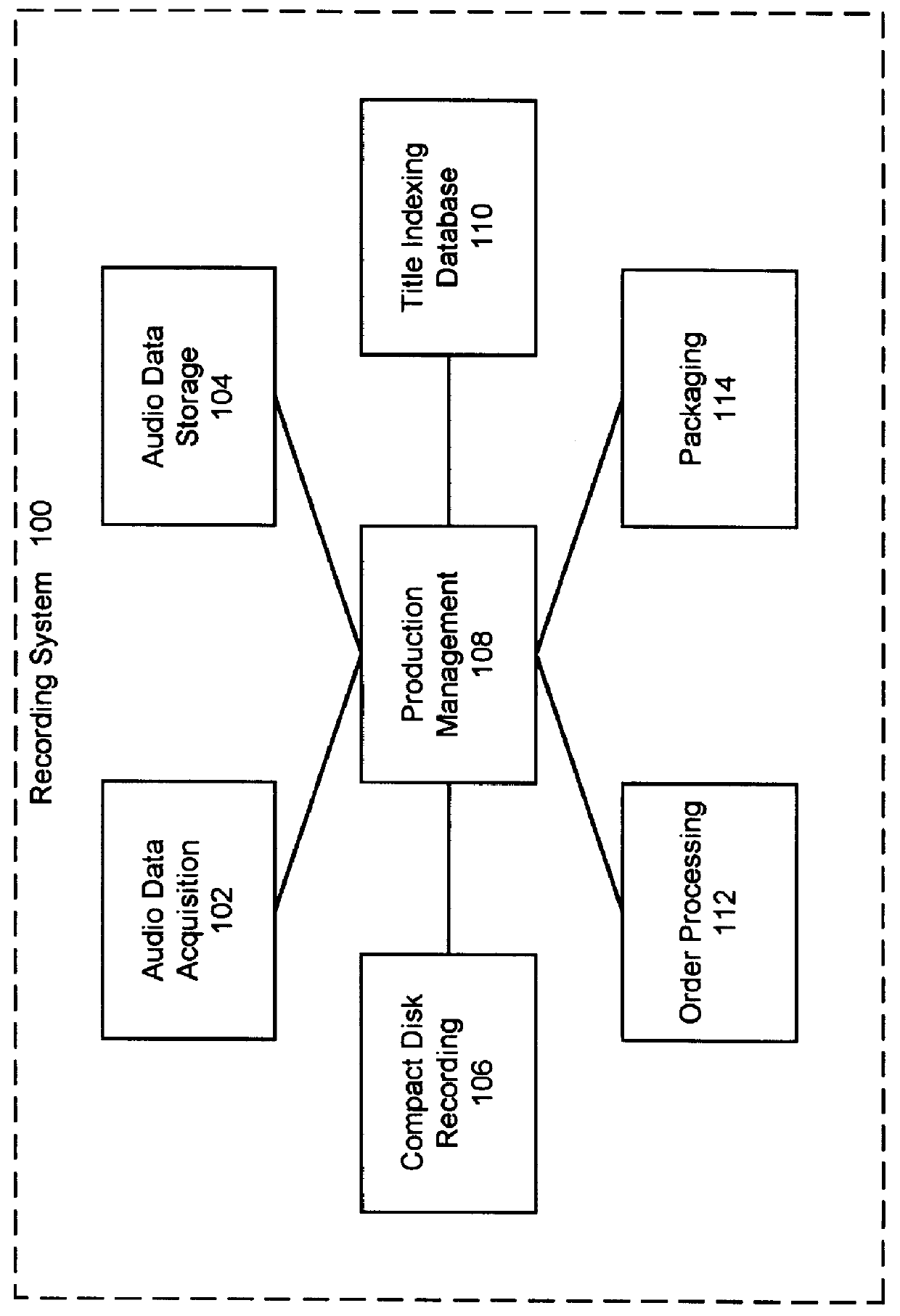

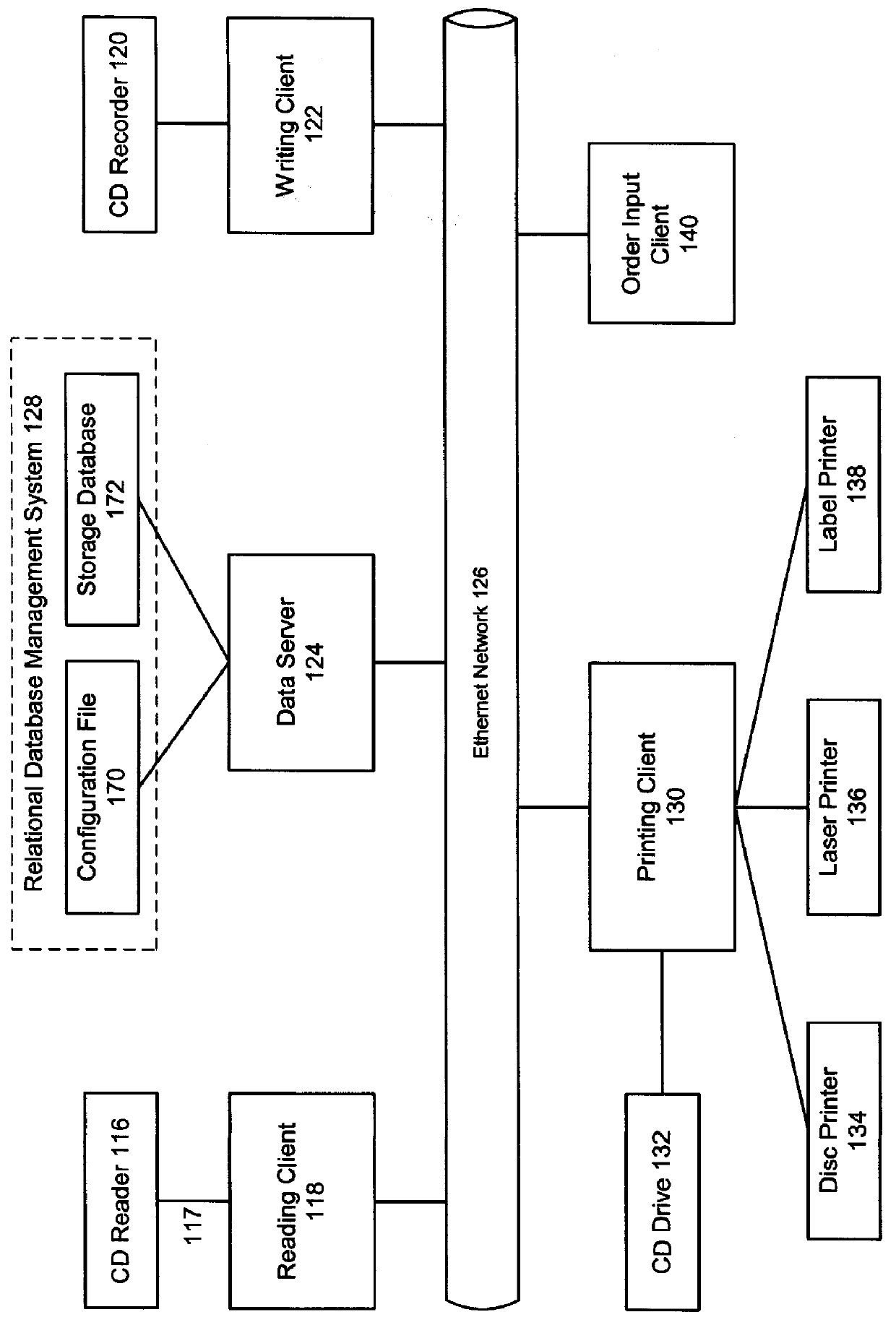

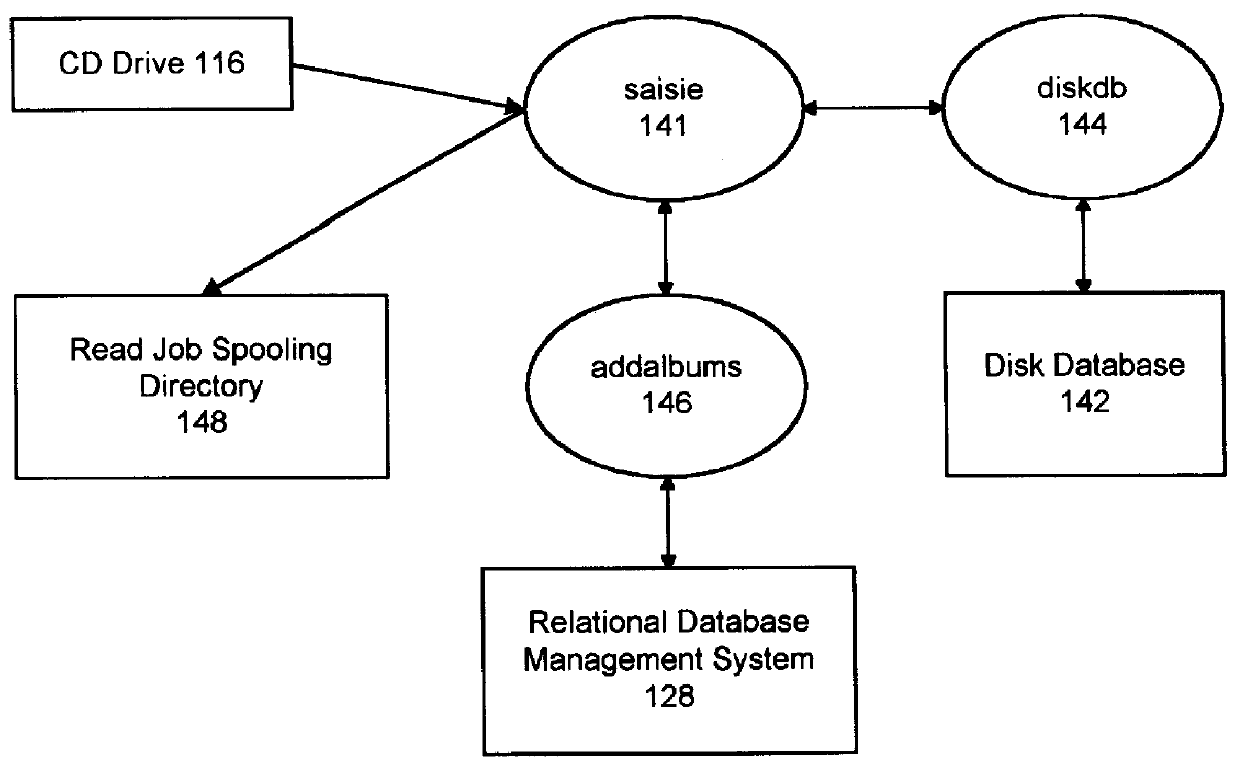

System and method for production of compact discs on demand

InactiveUS6011758ALayered productsElectronic editing digitised analogue information signalsDigital dataCompact disc

A system and method for production of customized compact discs (CD) includes compiling a collection of digital data files from source CDS, receiving customer orders and processing those customer orders by writing customer-selected digital data files onto a CD. Data files are read from the source CDs by an acquisition station and stored in a storage subsystem distributed over a number of data servers. A order input client receives and logs orders from customers. The customer orders are then processed by data servers transferring the cuistomer-selected data files to a writing station. The writing station records the data onto a destination CD. A printing station then prints content description information on the CD and jacket and also prints invoices and shipping labels.

Owner:MUSICMAKER COM

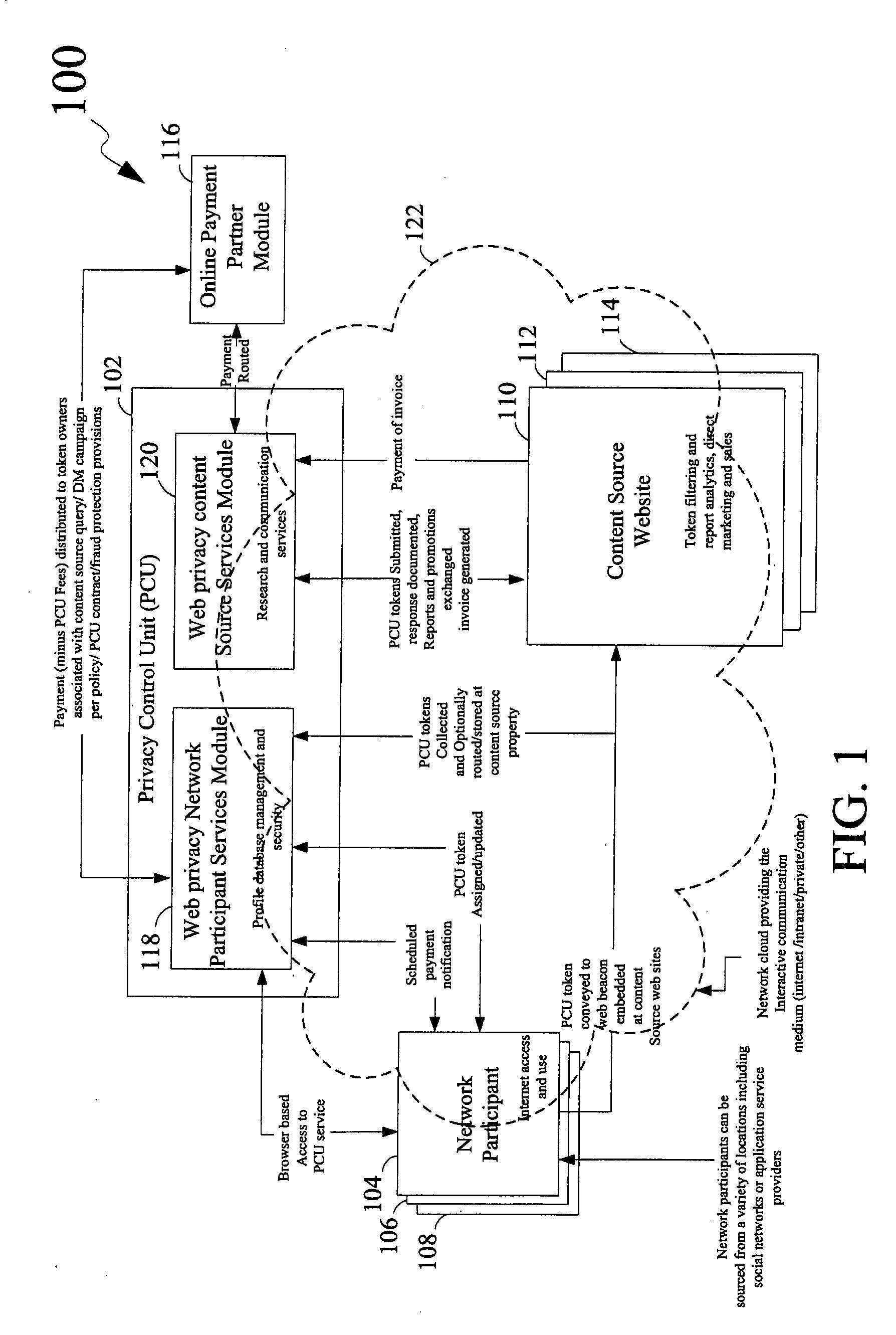

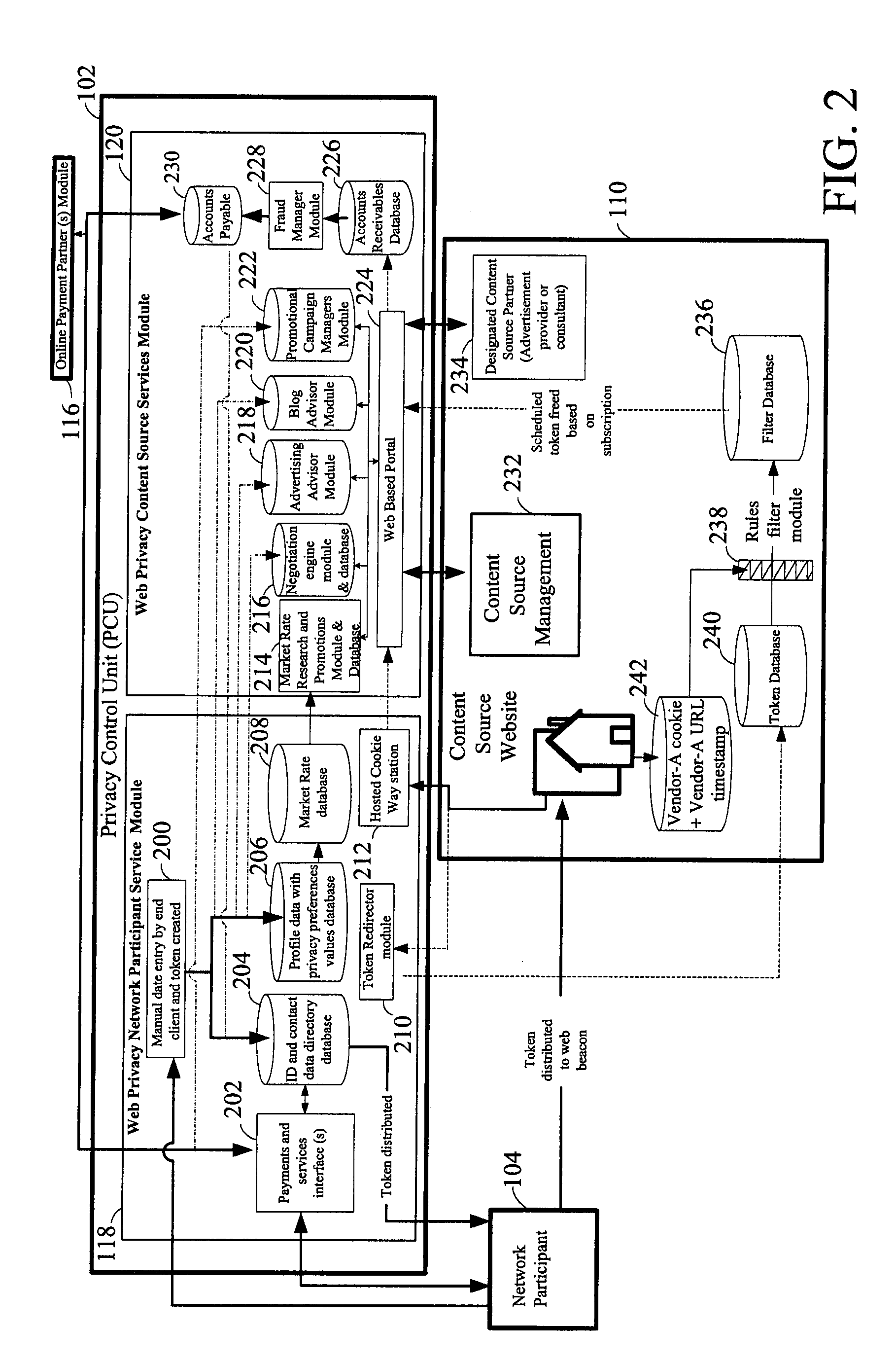

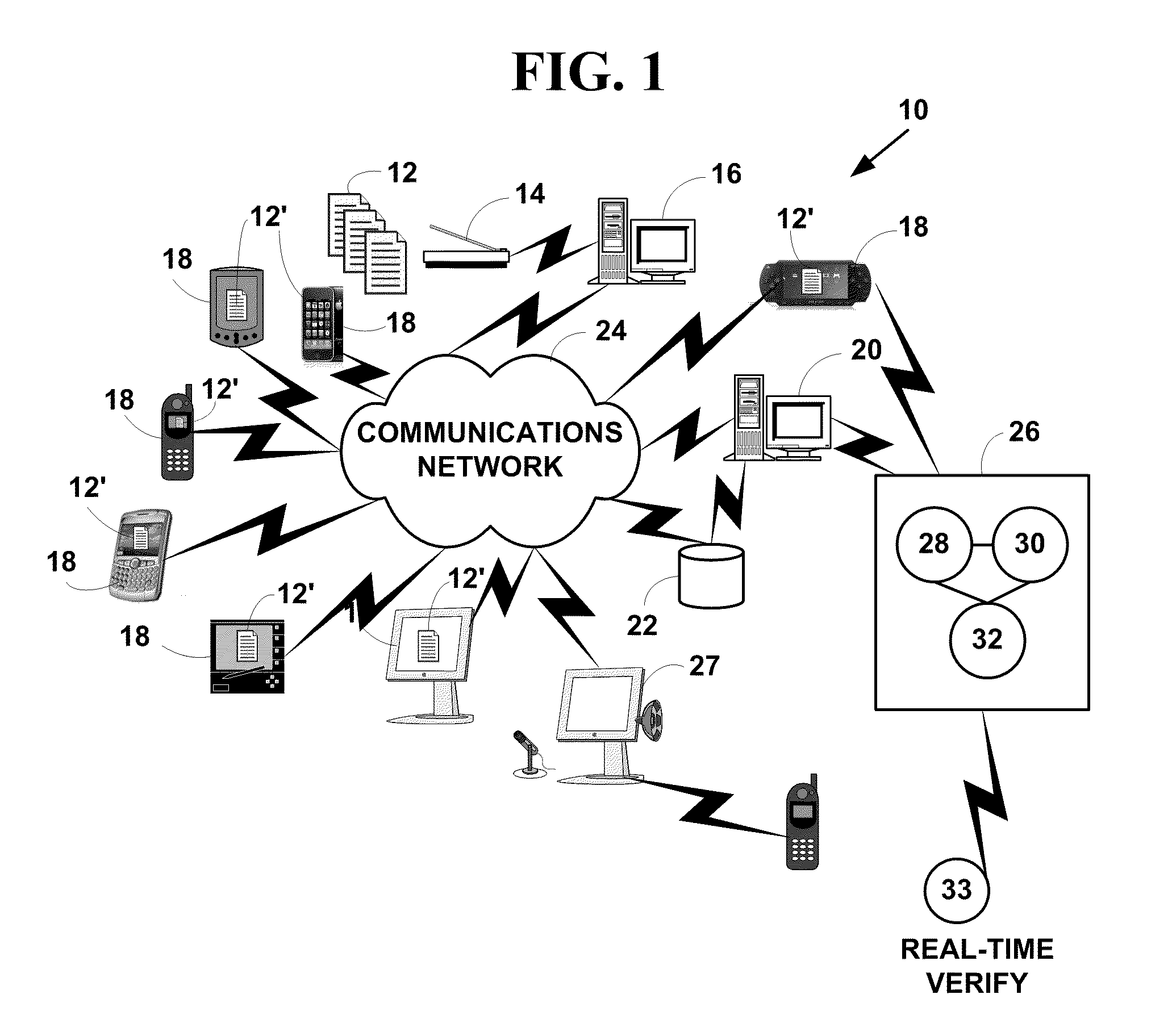

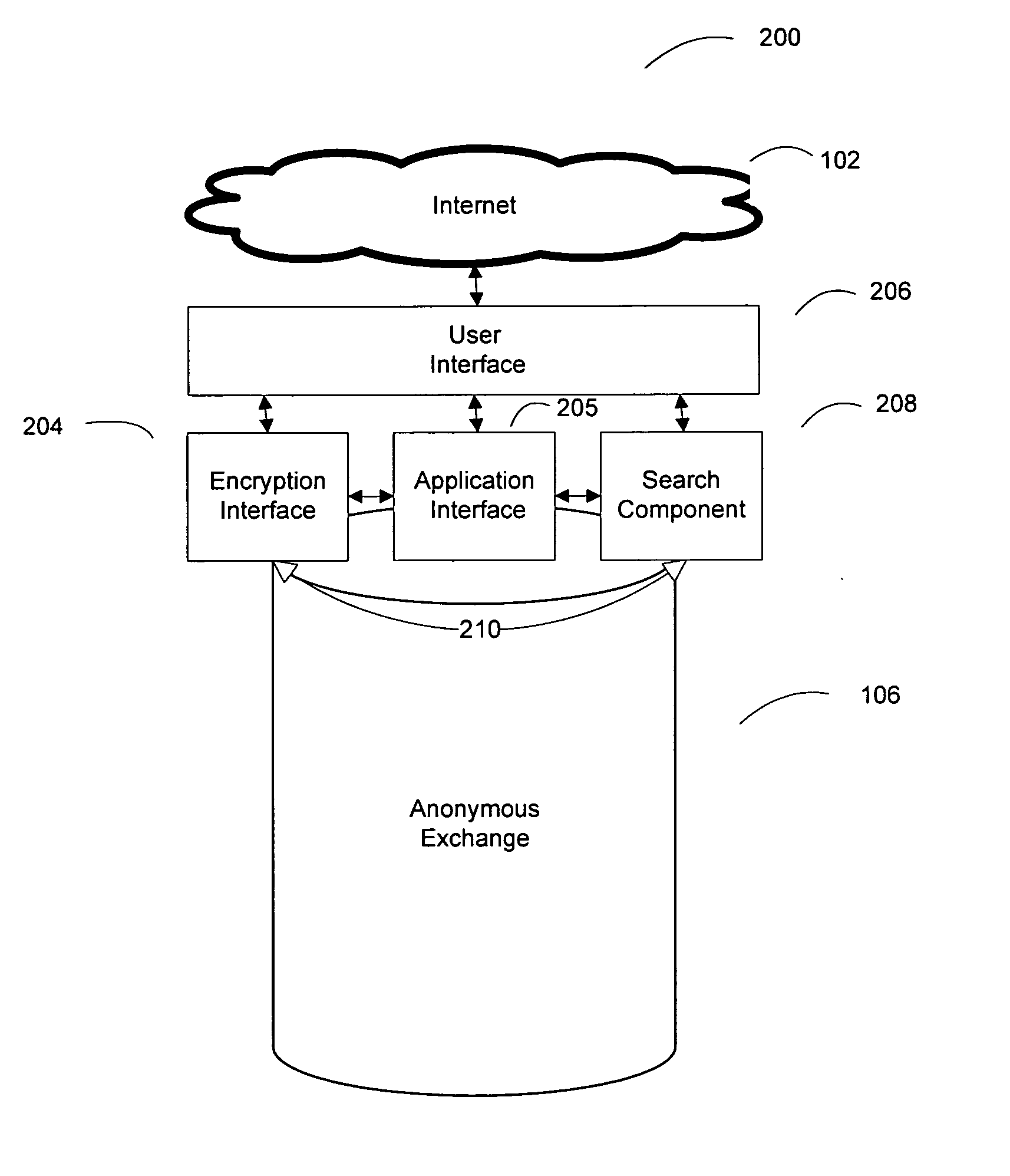

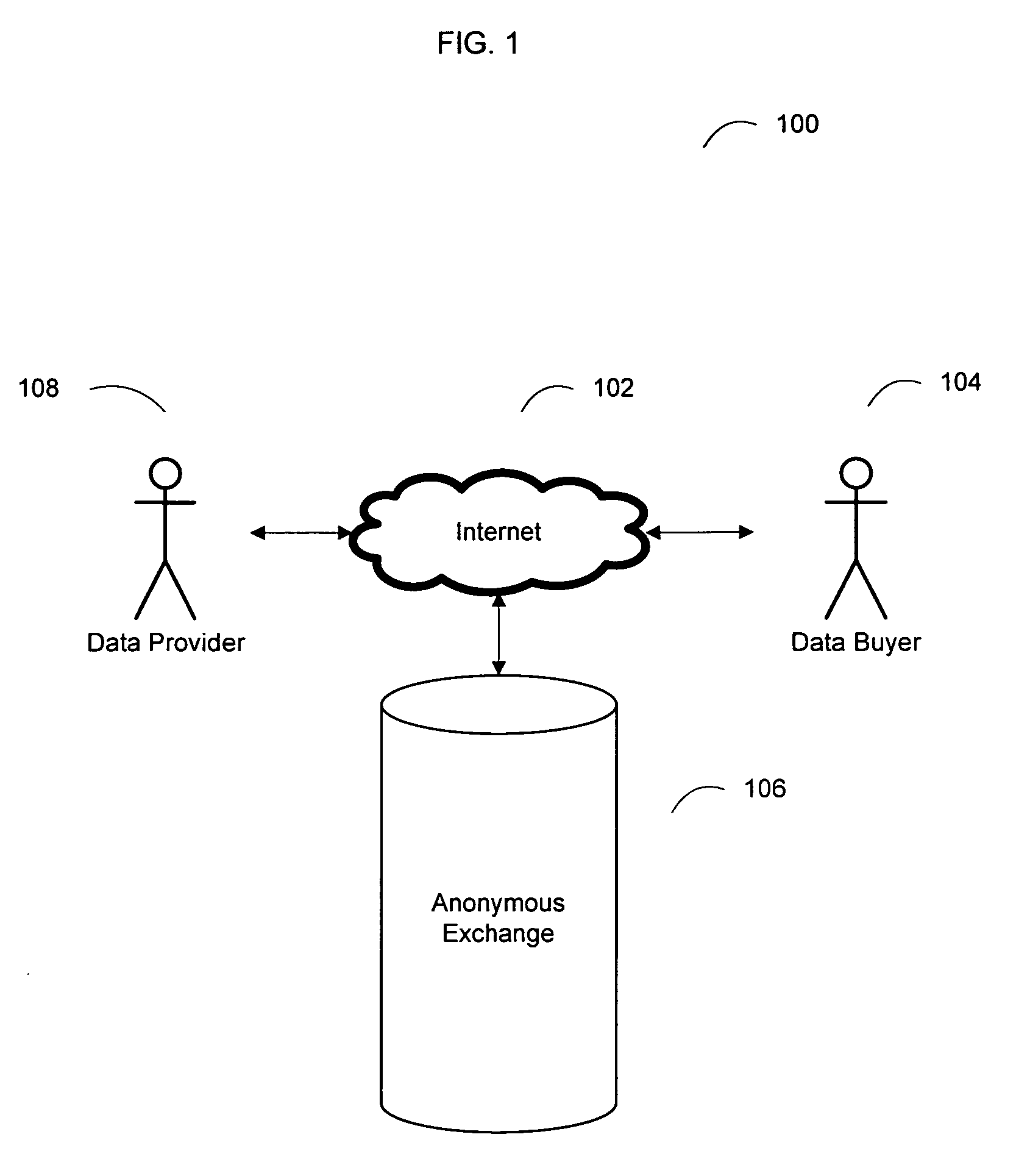

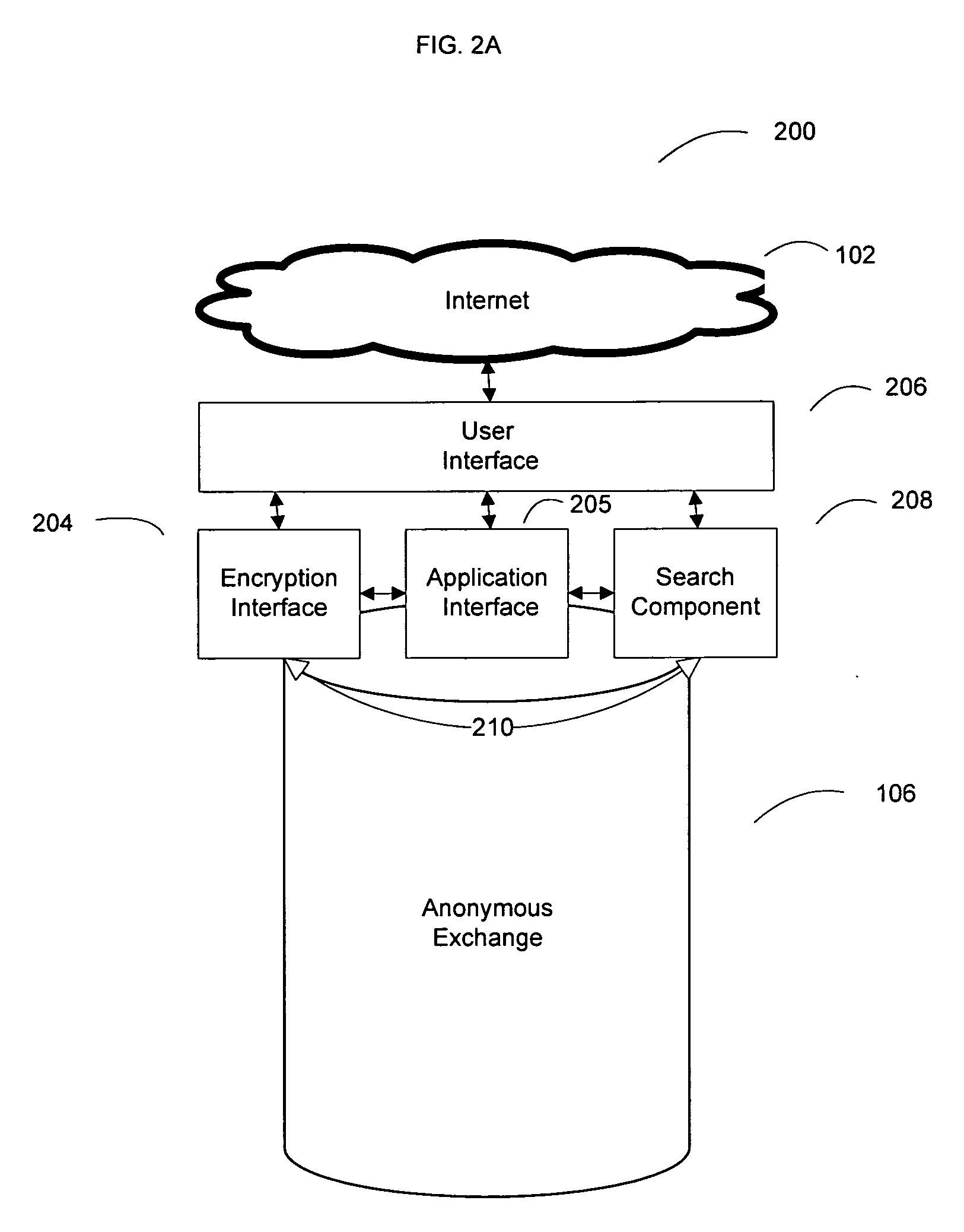

System for Enabling Secure Private Exchange of Data and Communication Between Anonymous Network Participants and Third Parties and a Method Thereof

Disclosed is a method for providing secure private exchange of a profile data of a network participant between the participant and a plurality of third parties. The method comprises registering profile data by the network participant with a privacy control unit, assigning privacy levels to each of the plurality of attributes of the profile data, transferring the profile data along with privacy levels assigned to each of a plurality of attributes of the profile data to a privacy control unit generating a report for research and for targeting promotion campaigns to the network participant by using the profile data. The report is accessed by the plurality of third parties for communications with the network participant, wherein the plurality of third parties are registered with and invoiced by the privacy control unit. A portion of the invoice is provided as a fee to the network participant for providing the profile data.

Owner:KINDCAST

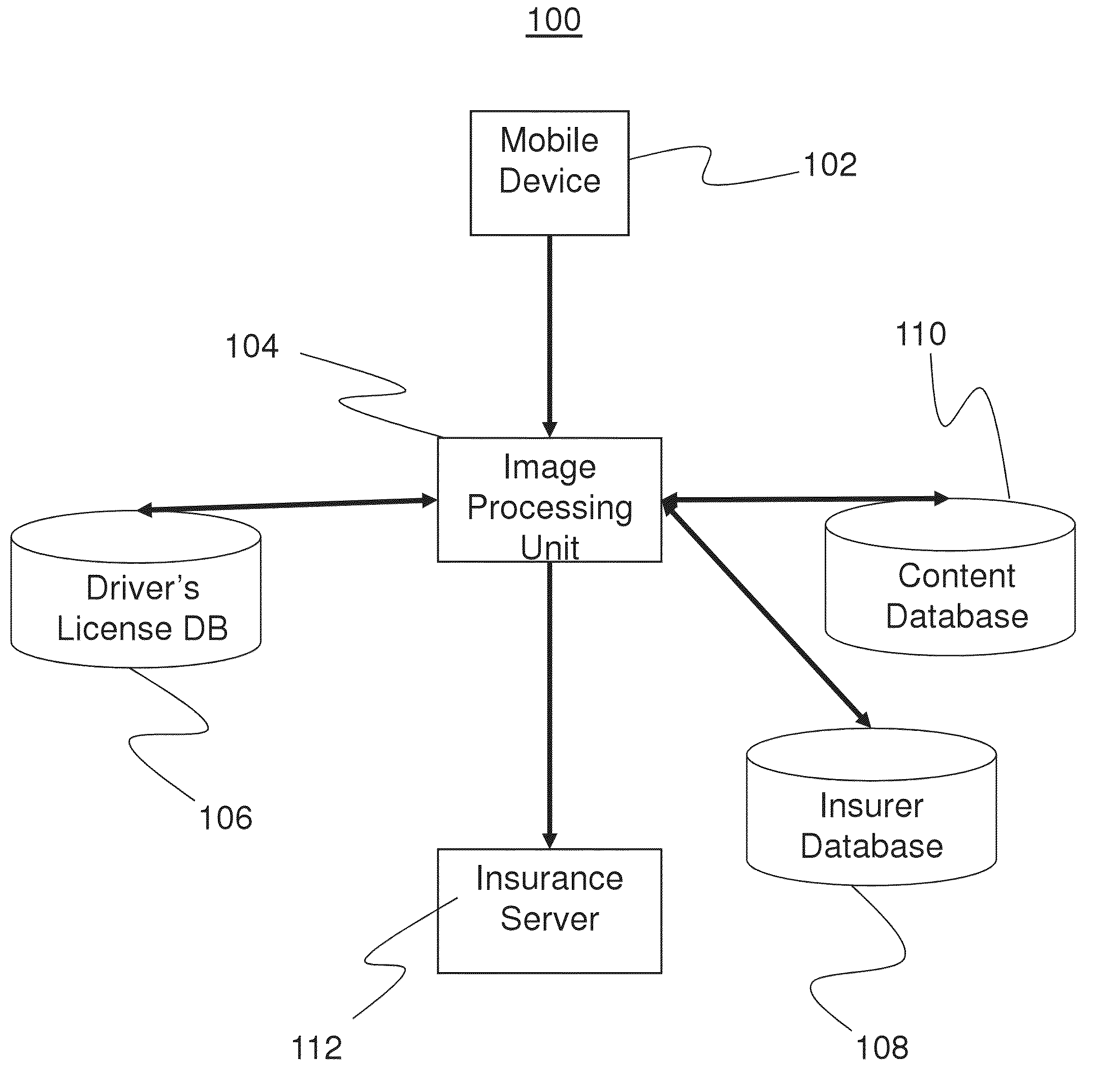

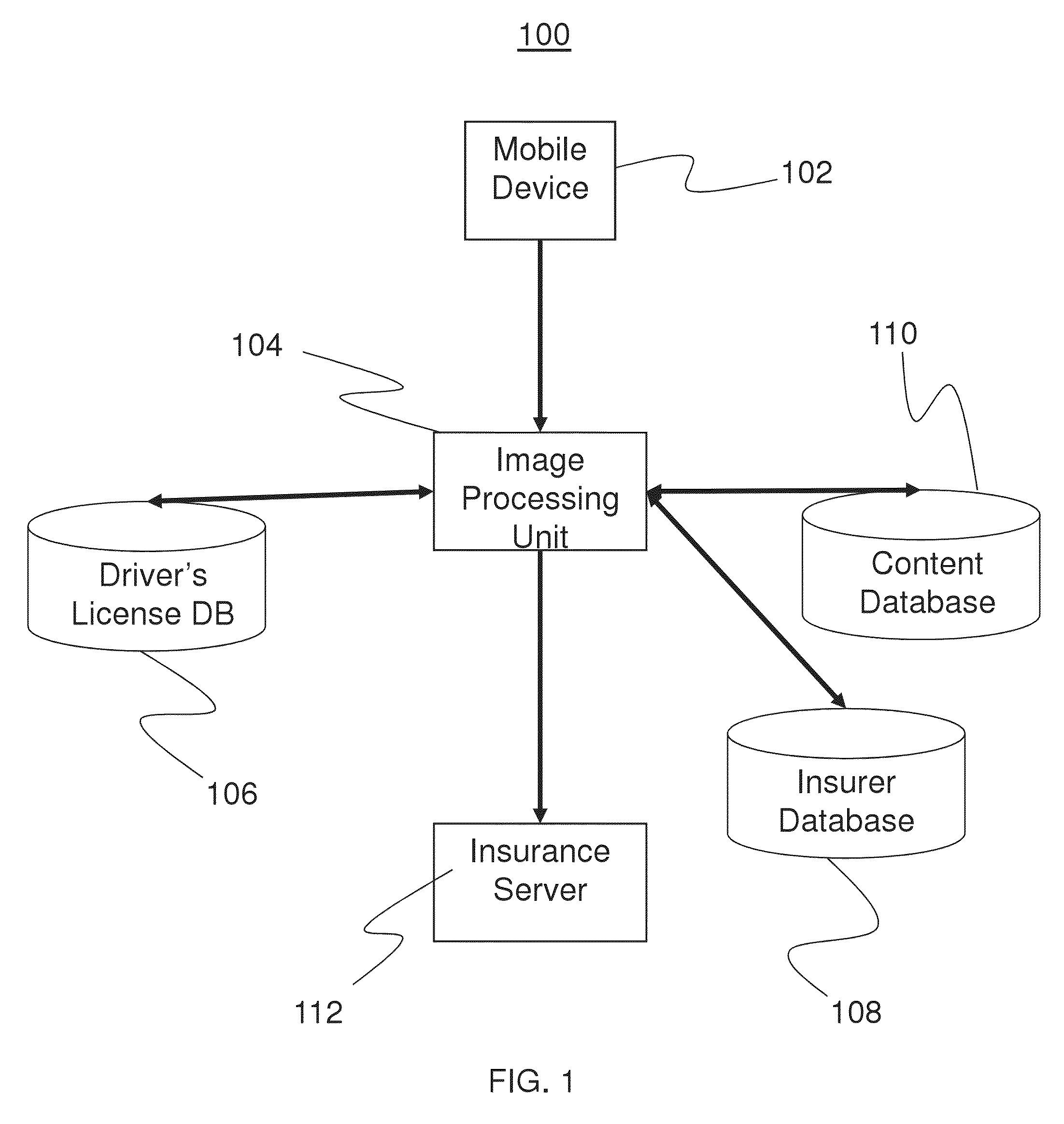

Systems and methods for filing insurance claims using mobile imaging

An application on a mobile device provides for the initiation and submission of an insurance claim by capturing information and images of documents using an image capture capability, then processing the images to extract content which is transmitted to an insurance company for processing of the claim. Documents such as an automobile insurance card (AIC), driver's license, vehicle identification number (VIN), license plate, police report, damage estimate and repair invoice may all be captured and processed by image processing techniques on the mobile device or an image processing unit in order to extract relevant content. Other features and capabilities of the mobile device—such as video and image capture, location-based services, accelerometers and tracking—may automatically populate relevant fields of a claim report and permit the user to upload photographic and video evidence of an accident and related damage.

Owner:STRANGE MIKE +1

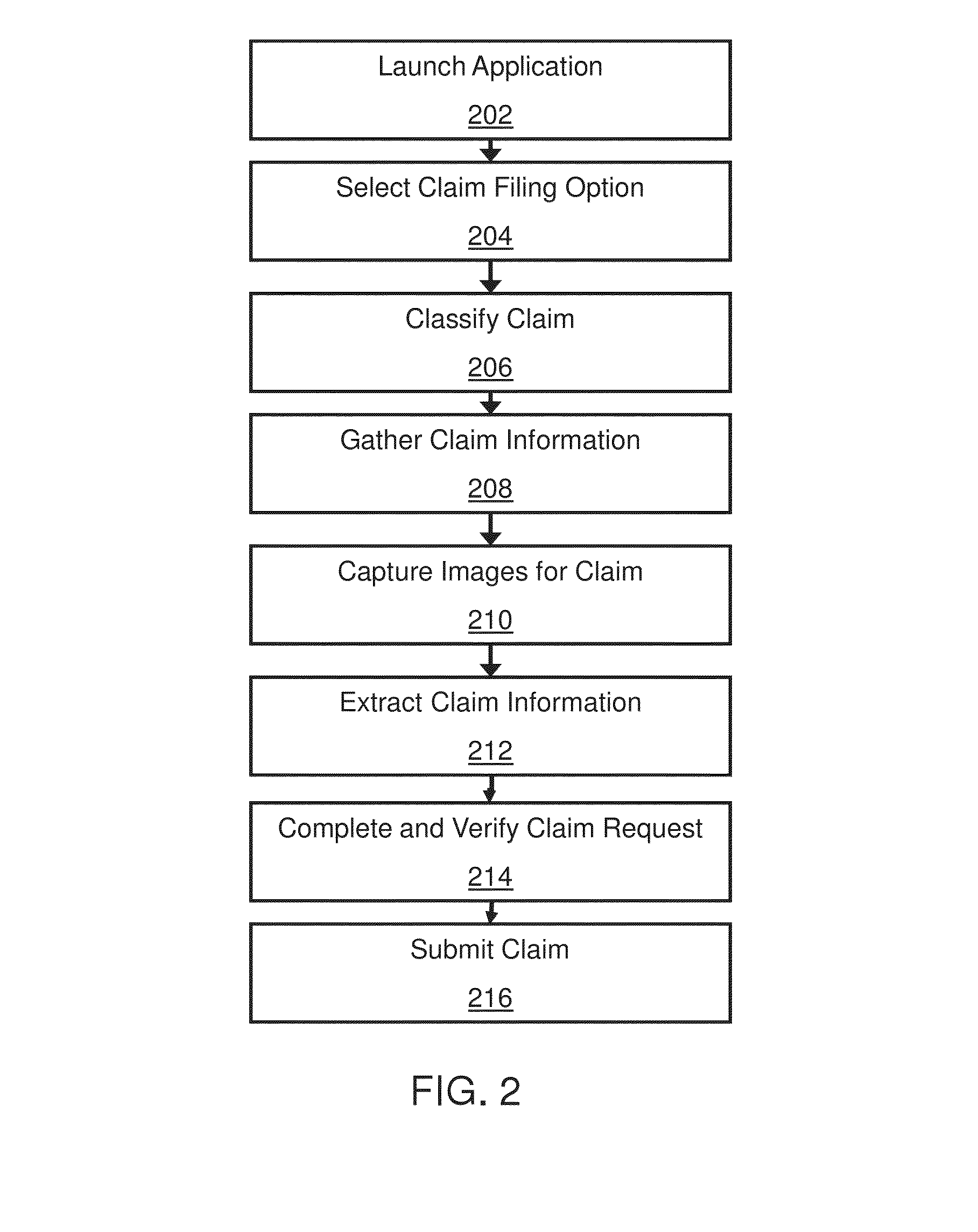

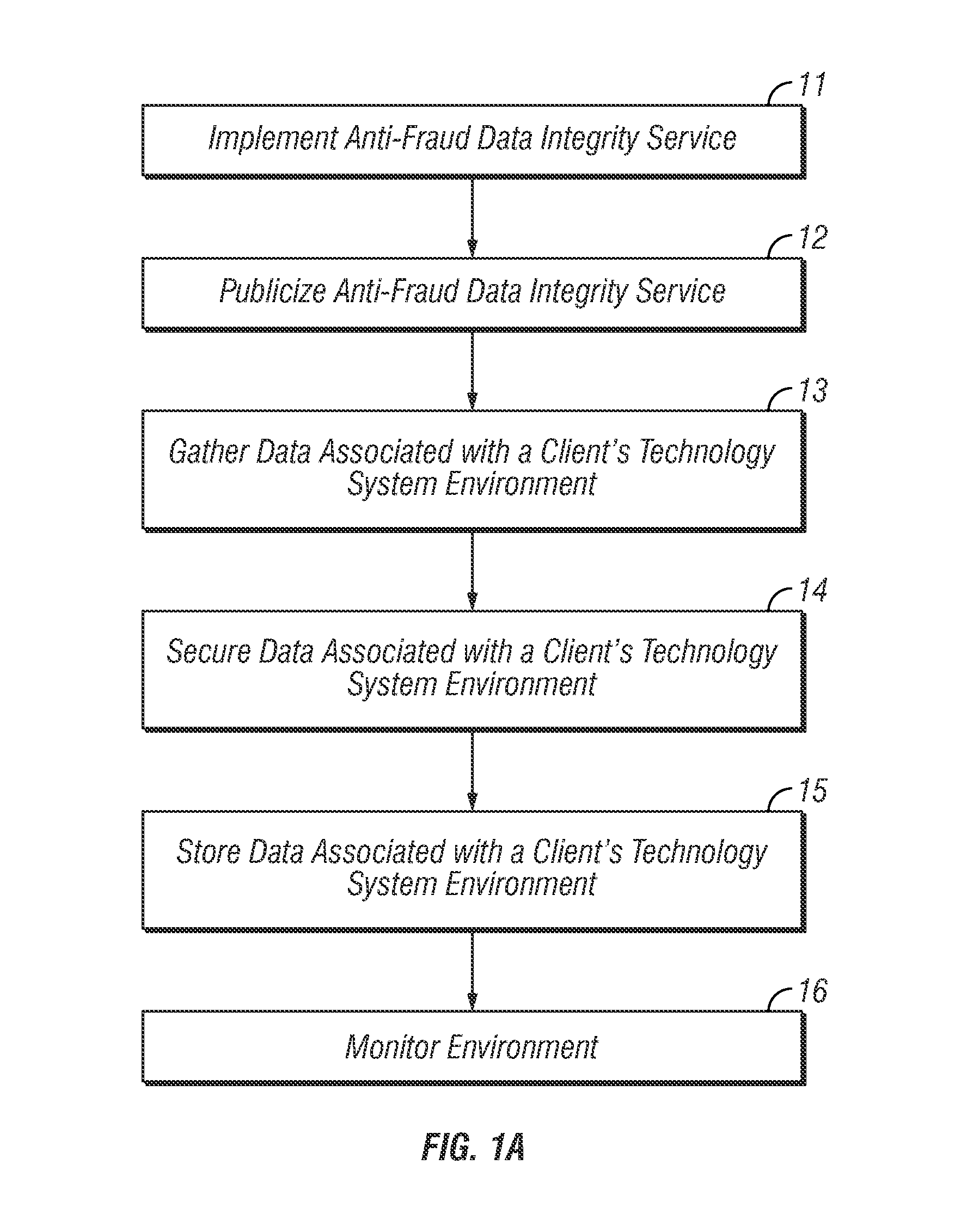

Method and apparatus for maintaining high data integrity and for providing a secure audit for fraud prevention and detection

ActiveUS8805925B2Easy to findReduce the burden onComplete banking machinesFinanceData integrityInvoice

Owner:NBRELLA

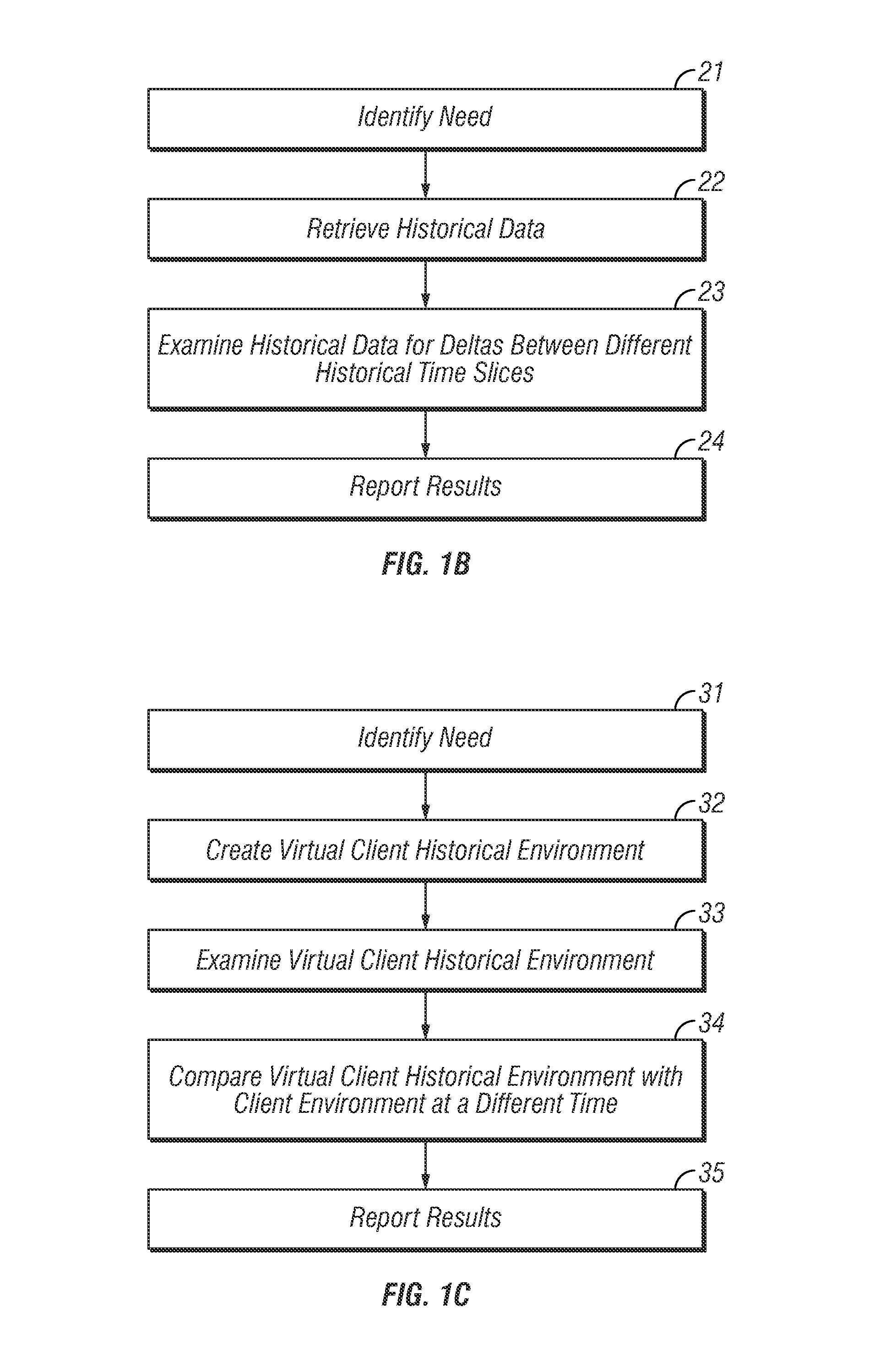

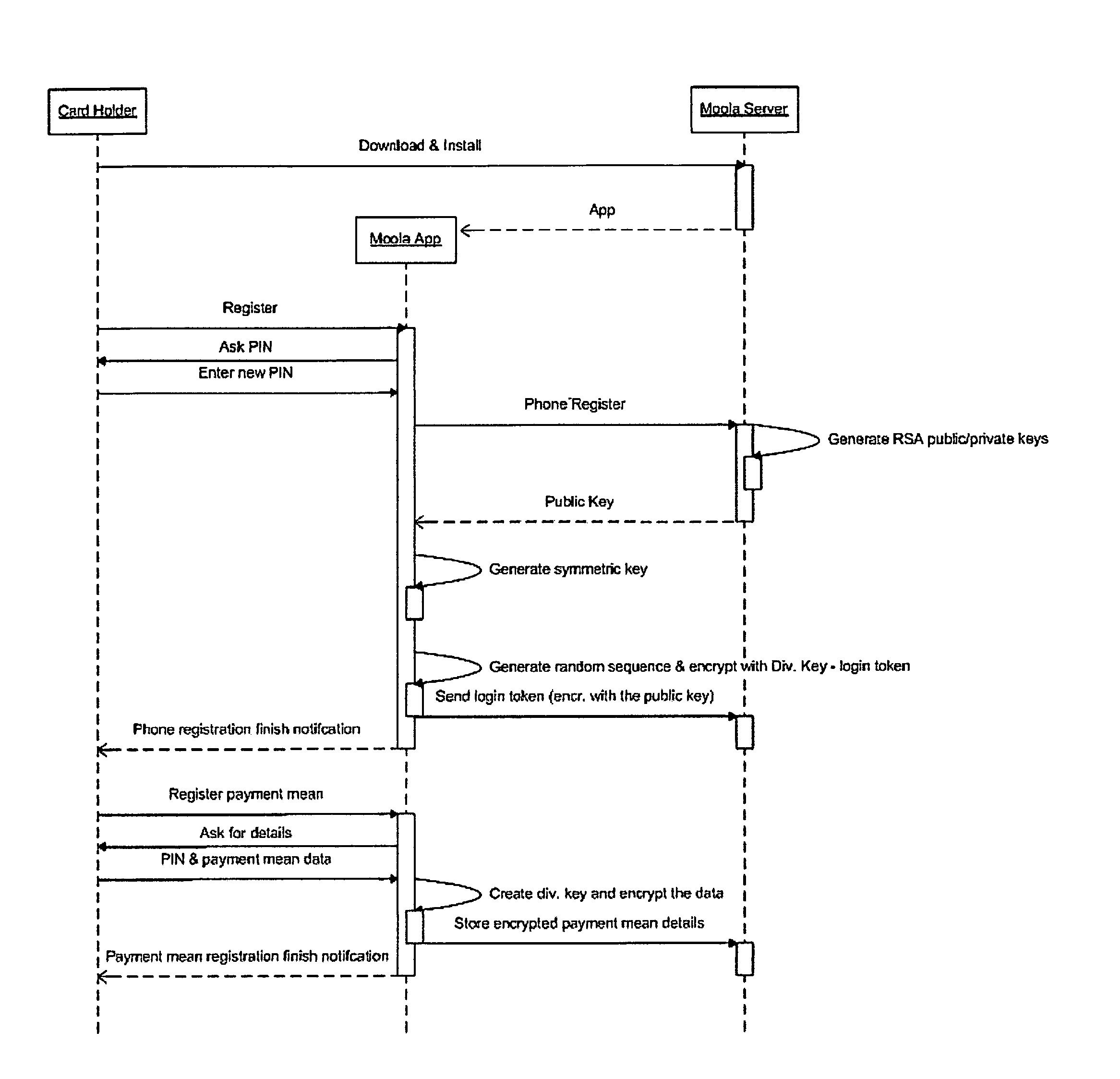

Mobile Device Based Financial Transaction System

A system and method for conducting financial transactions by means of a smartphone is disclosed. A barcode is printed on the invoice, which is scanned by the mobile device screen. The mobile device is used instead of a credit card or cash. Provisions for data security, transaction verification, and communications protocols are disclosed.

Owner:SINCAI DAN MOSHE

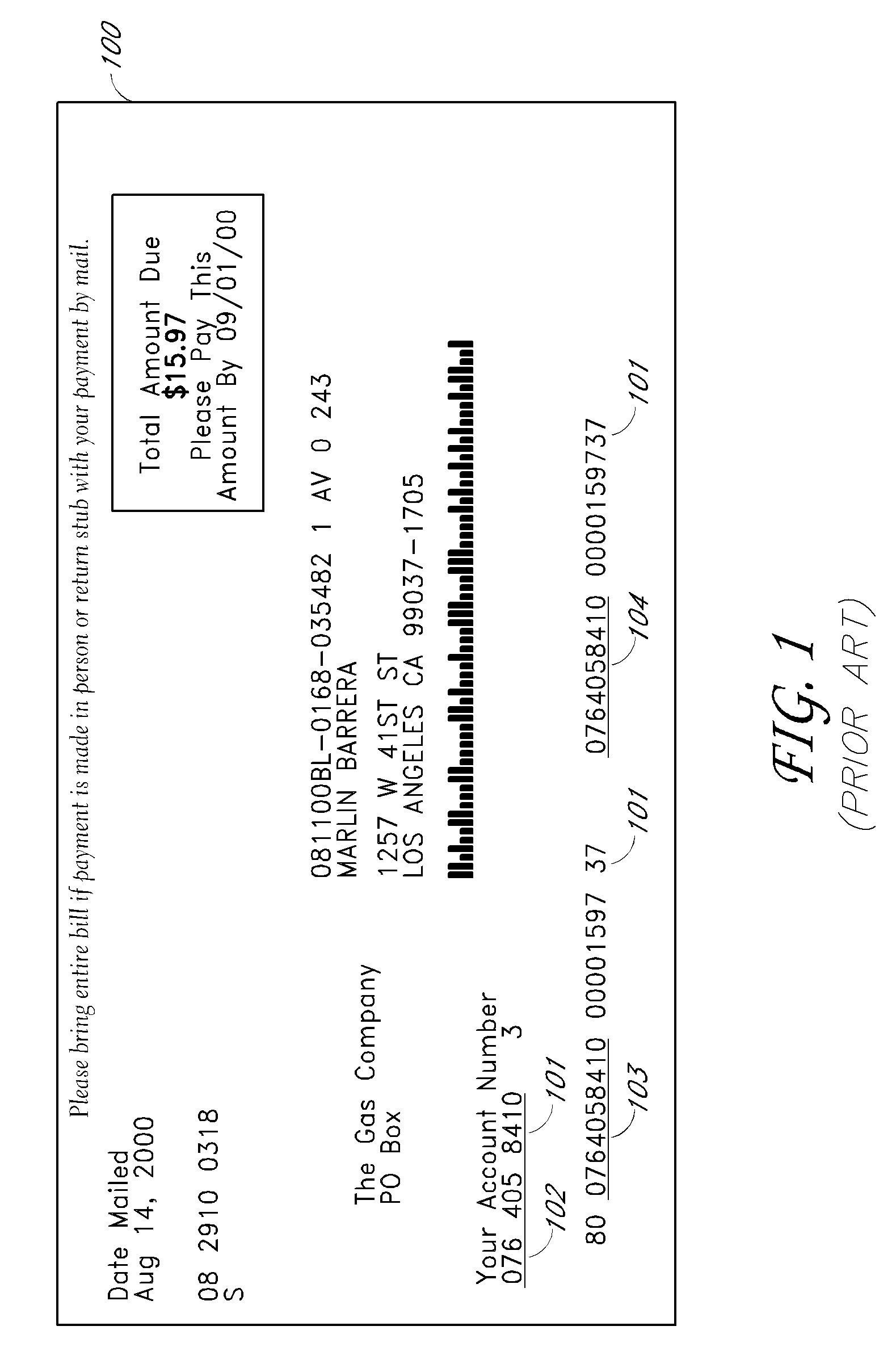

Bar coded bill payment system and method

InactiveUS6993507B2Cost-free profit marginPay their bills more efficientlyComplete banking machinesFinanceThird partyInvoice

Owner:PAYSCAN AMERICA

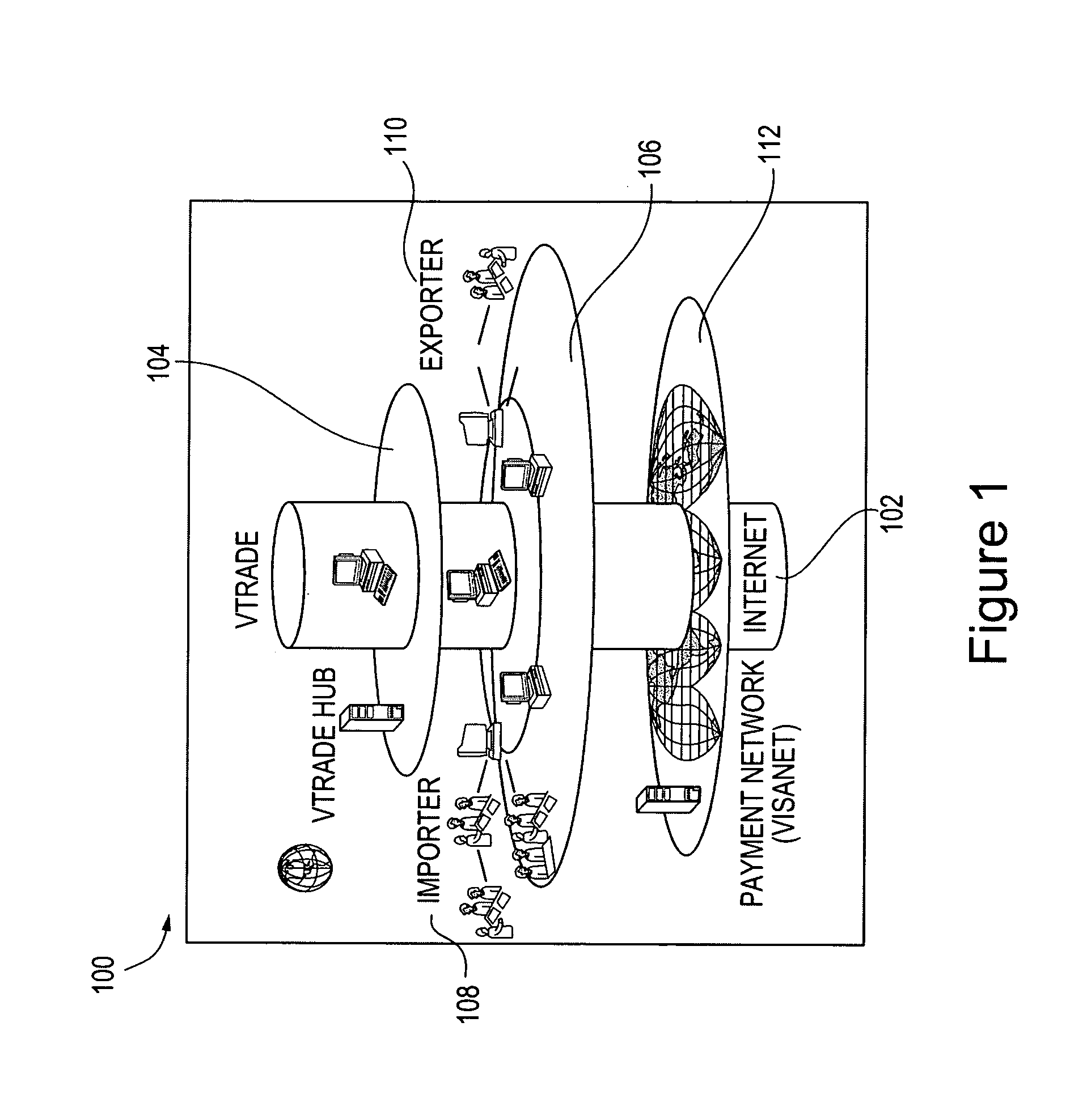

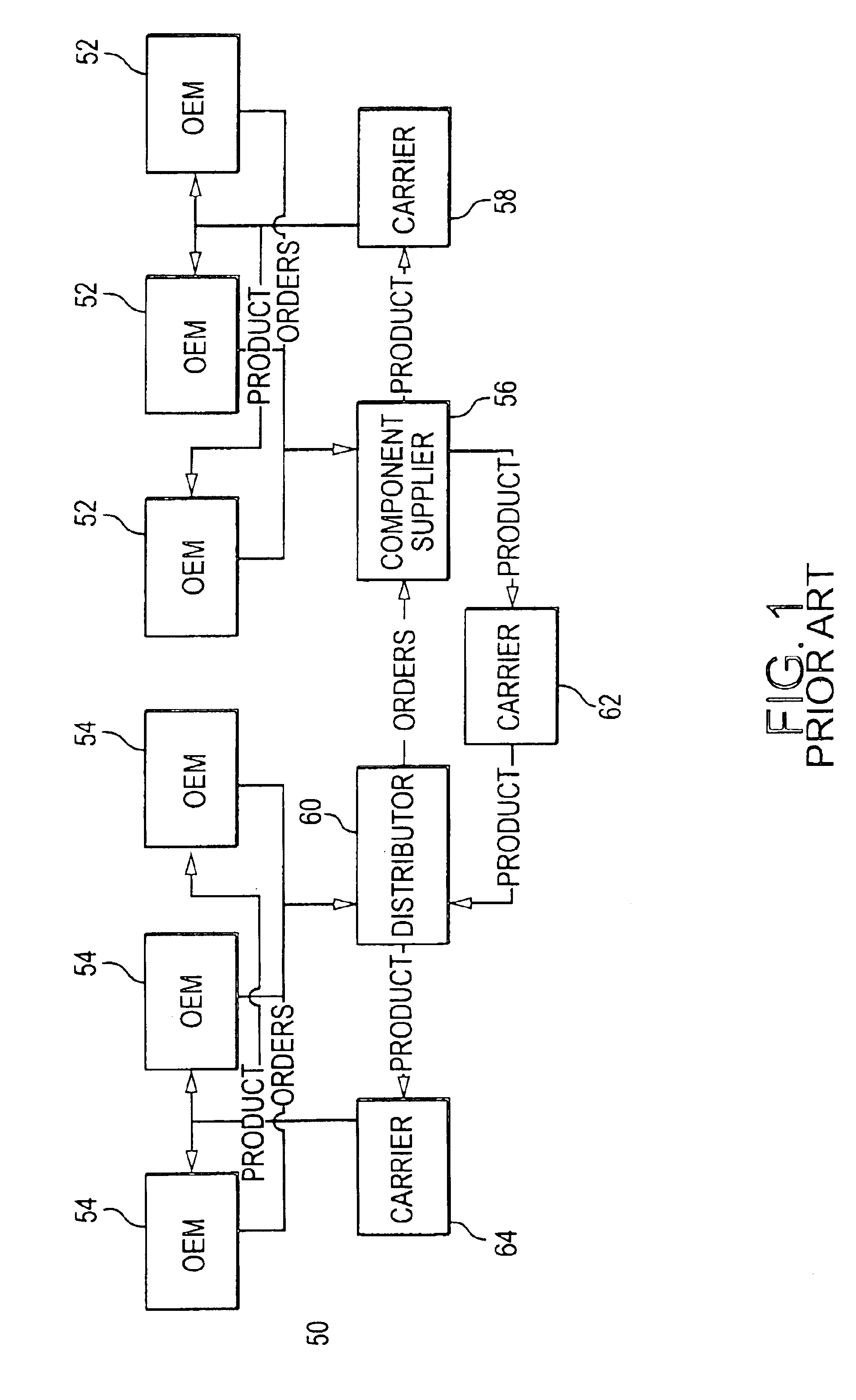

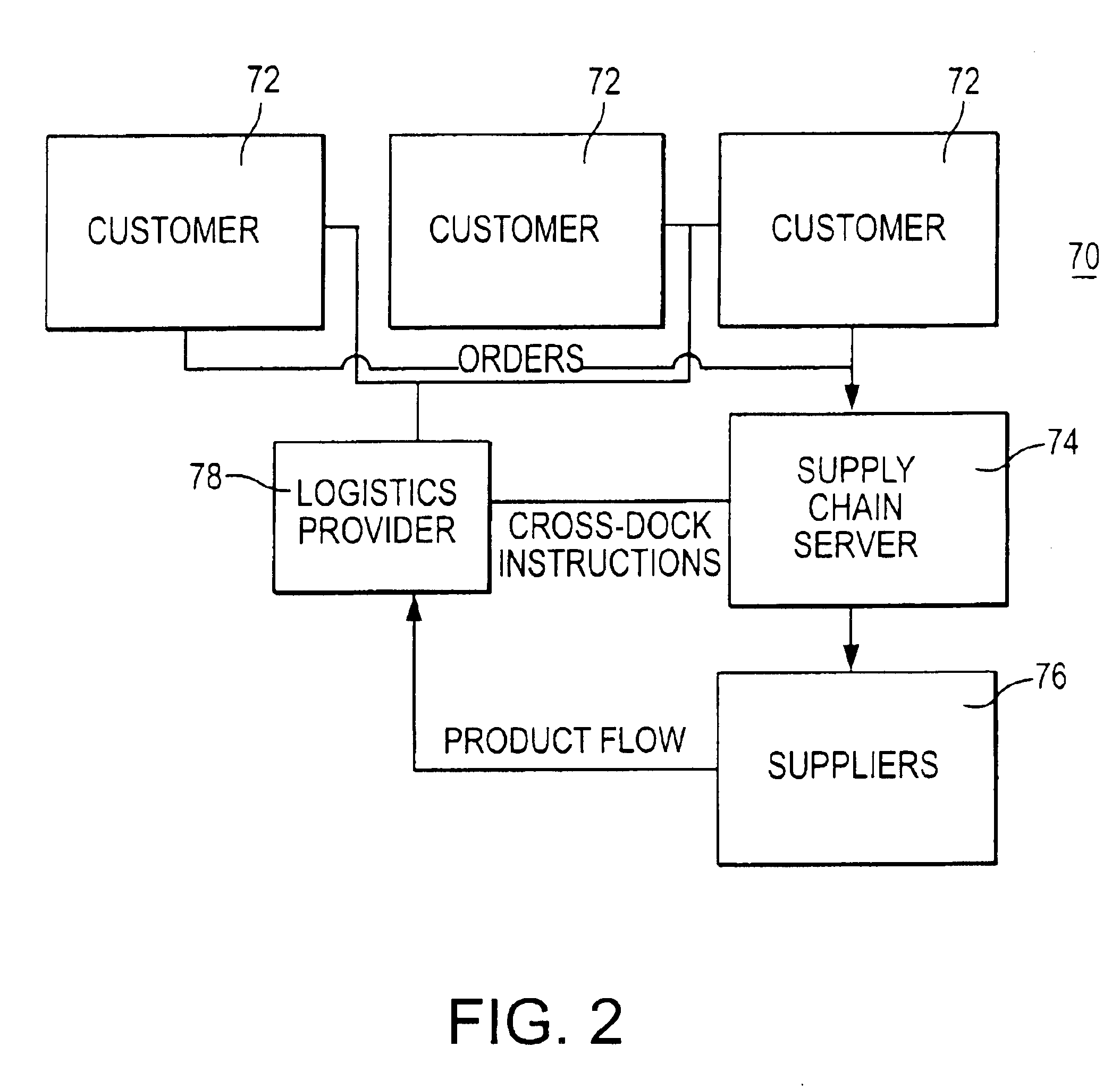

Supply chain architecture

InactiveUS7003474B2Improve the supplier's accounting booksReservationsResourcesPaymentLogistics management

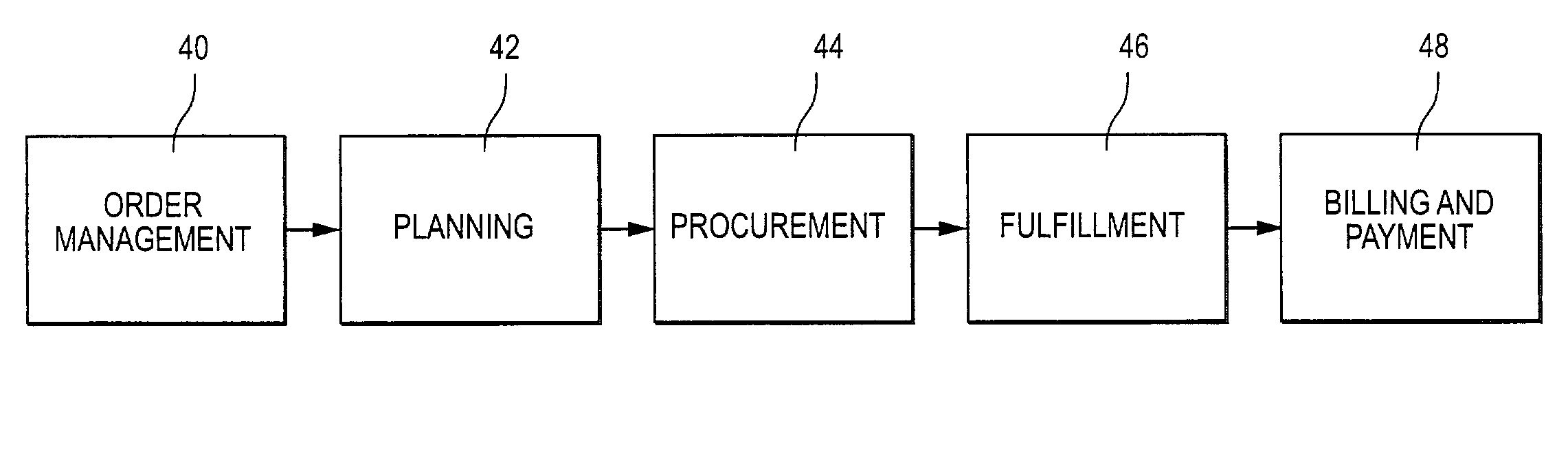

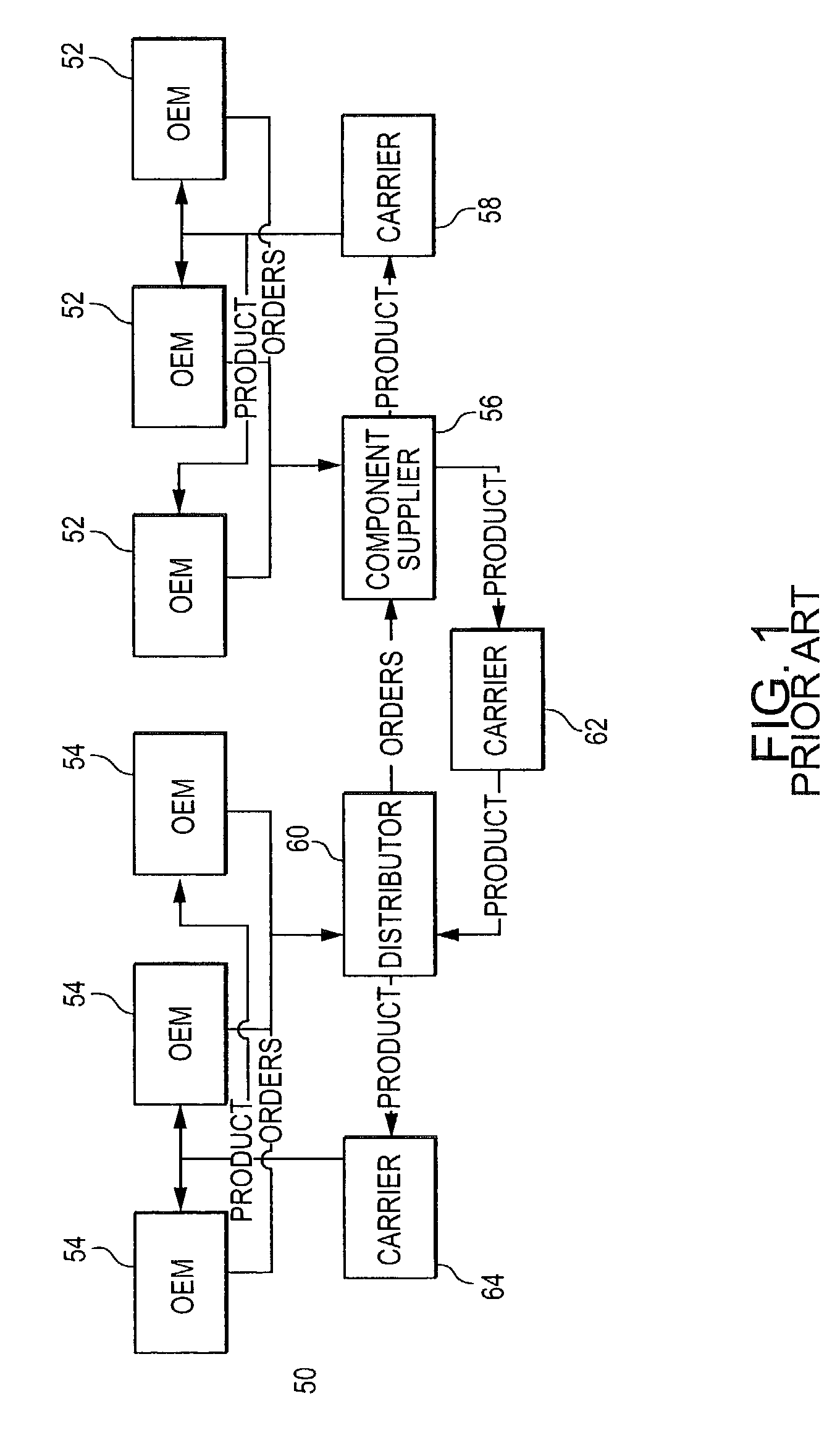

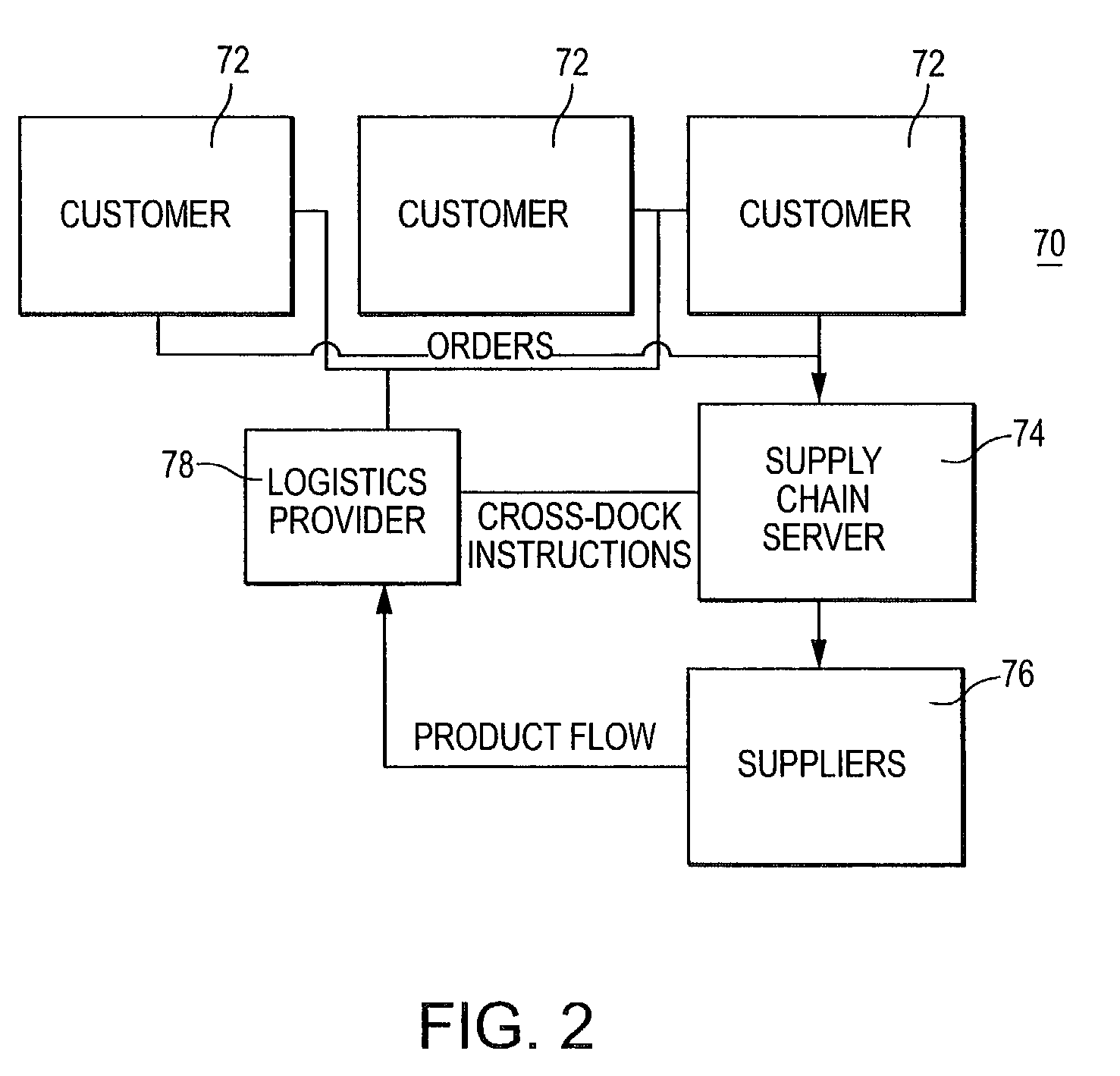

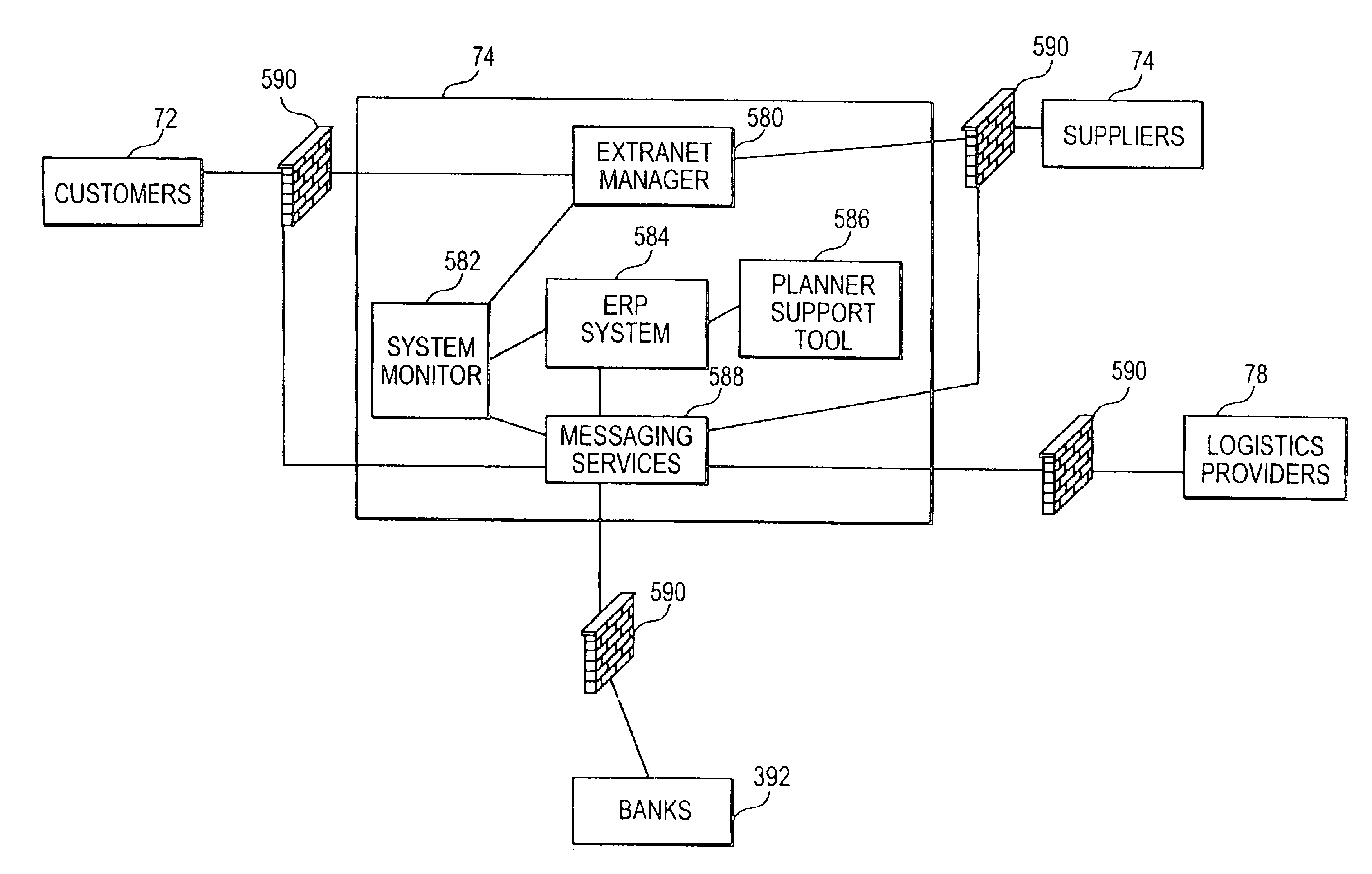

A supply chain network where customers, suppliers, logistics providers, carriers, and financial institutions are all connected to a centralized supply chain server. The server receives forecasts from the customers detailing the orders that the customers desire. These forecasts are analyzed by the supply chain server to ensure that they conform to contractual agreements and do not contain errors. The forecasts are also used to warn the suppliers of future demands so that the suppliers can anticipate demands and plan inventory accordingly. Once supplier demand issues are resolved, the forecasts are sent to the suppliers in groups so that the suppliers prepare a smaller number of large orders. The supply chain server also controls the processes involved in distributing the product from the suppliers to the customers including the generation and payment of invoices. A form of financing the customers' purchases, made possible by the supply chain architecture, is also disclosed.

Owner:ISUPPLI

Supply chain architecture

InactiveUS6889197B2Improve the supplier's accounting booksReservationsResourcesPaymentLogistics management

A supply chain network where customers, suppliers, logistics providers, carriers, and financial institutions are all connected to a centralized supply chain server. The server receives forecasts for direct material procurement from the customers detailing the orders that the customers desire. These forecasts are analyzed by the supply chain server to ensure that they conform to contractual agreements and do not contain errors. The supply chain server sends the forecasted demands to at least one supplier after determining the forecasts are valid. The supply chain server controls the processes involved in distributing the product from the suppliers to the customers including the generation and payment of invoices. A form of financing the customers' purchases, made possible by the novel supply chain architecture, is also disclosed.

Owner:ISUPPLI

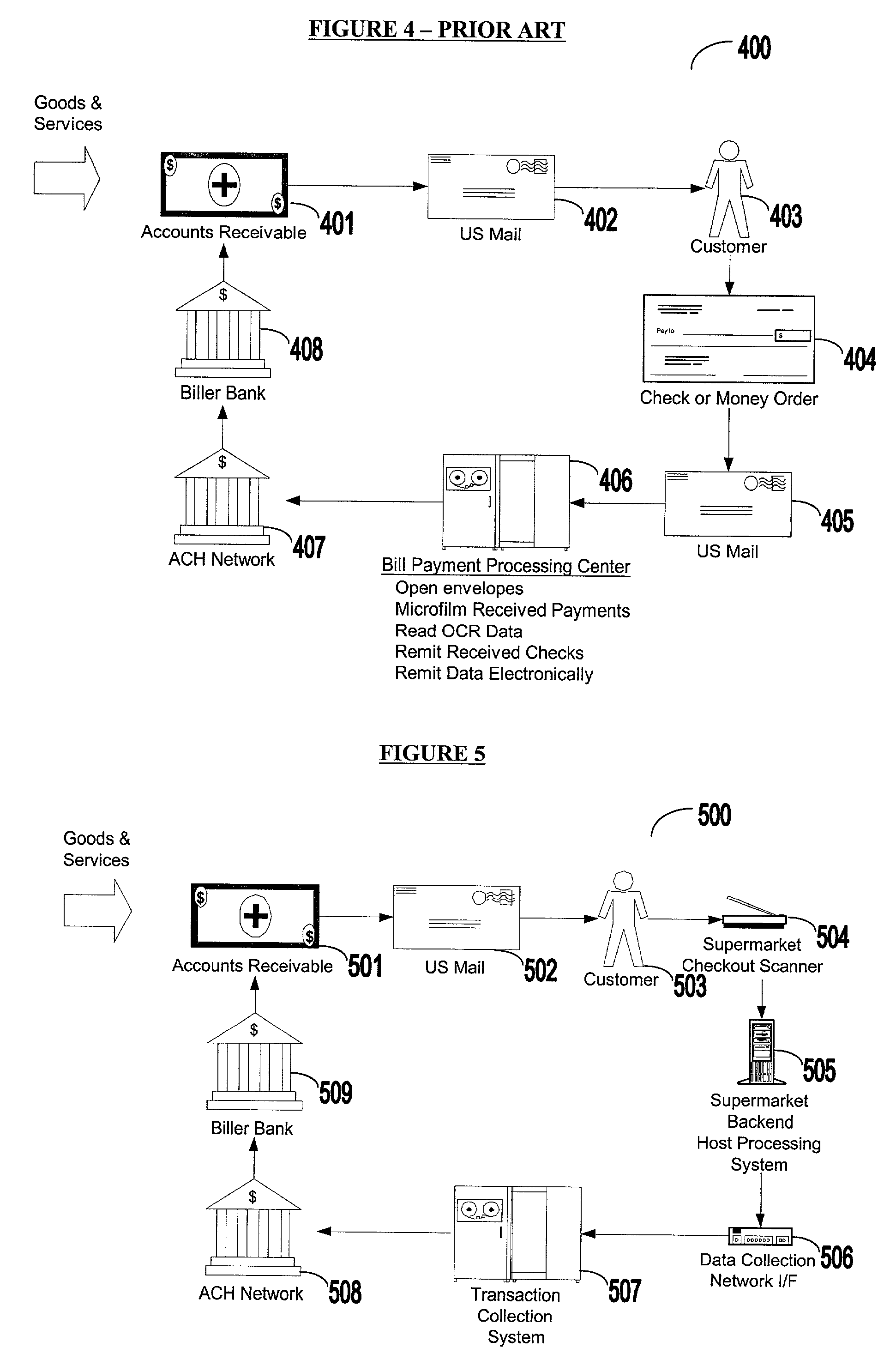

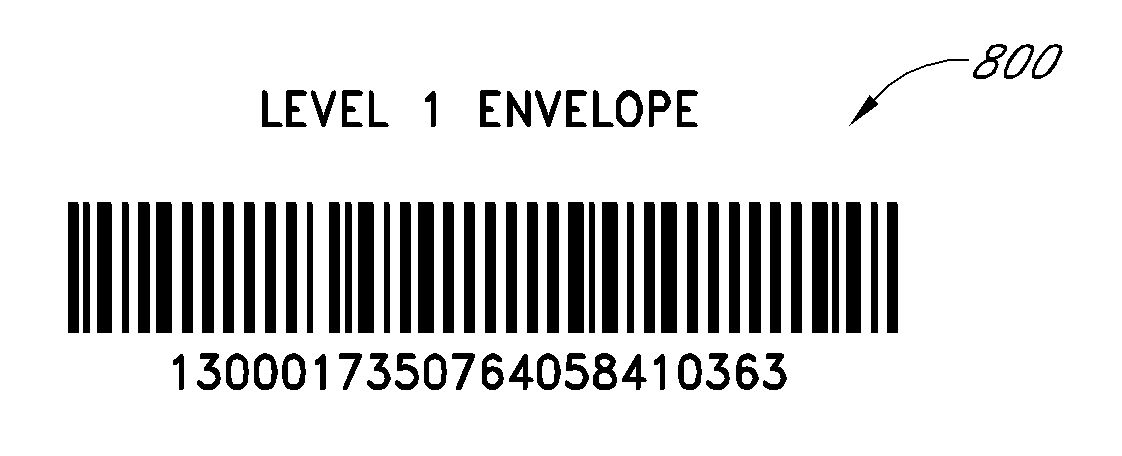

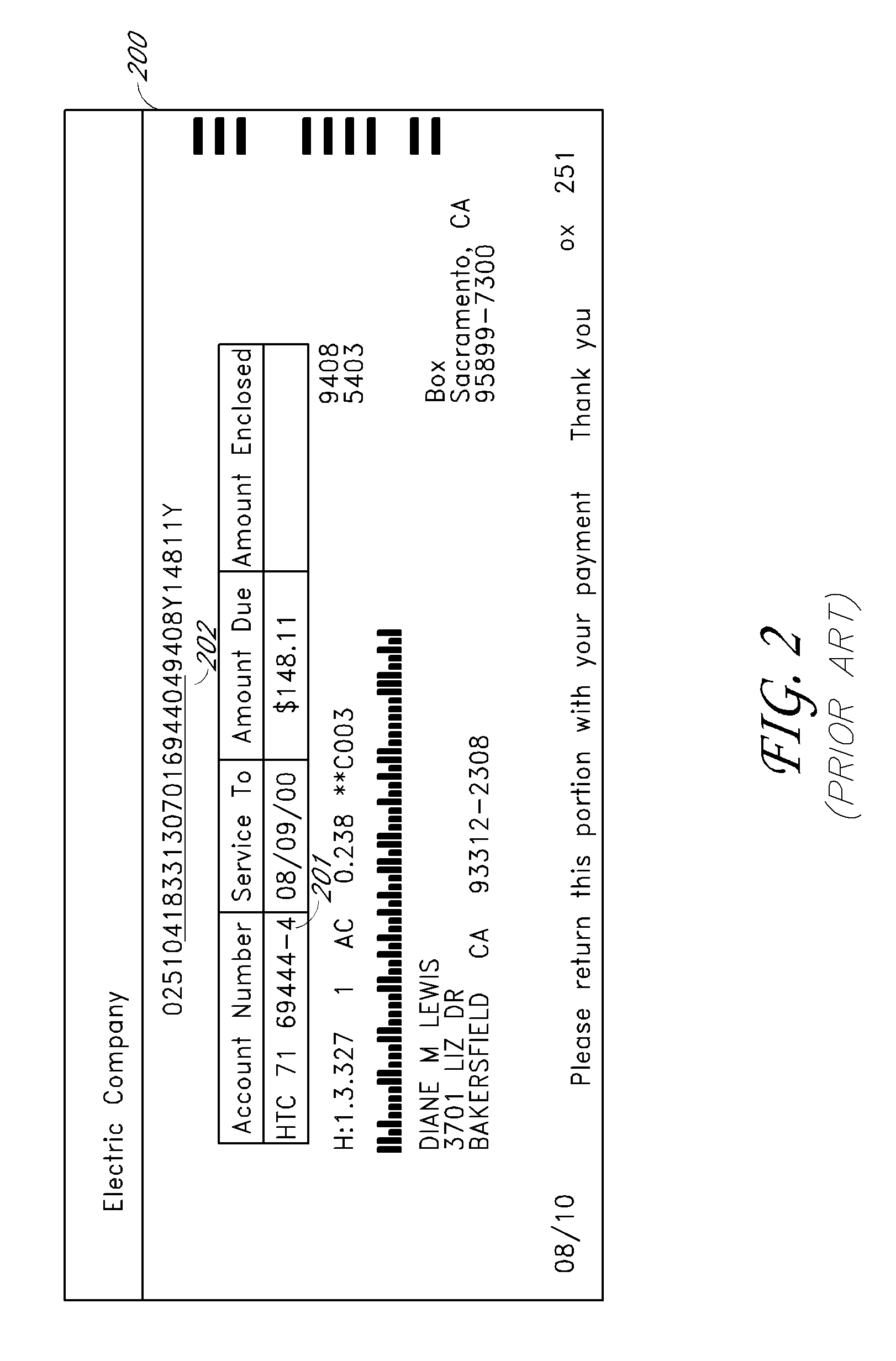

Bar coded monetary transaction system and method

InactiveUS20090108080A1Cost-free profit marginSave of in collectionPayment architectureRecord carriers used with machinesThird partyInvoice

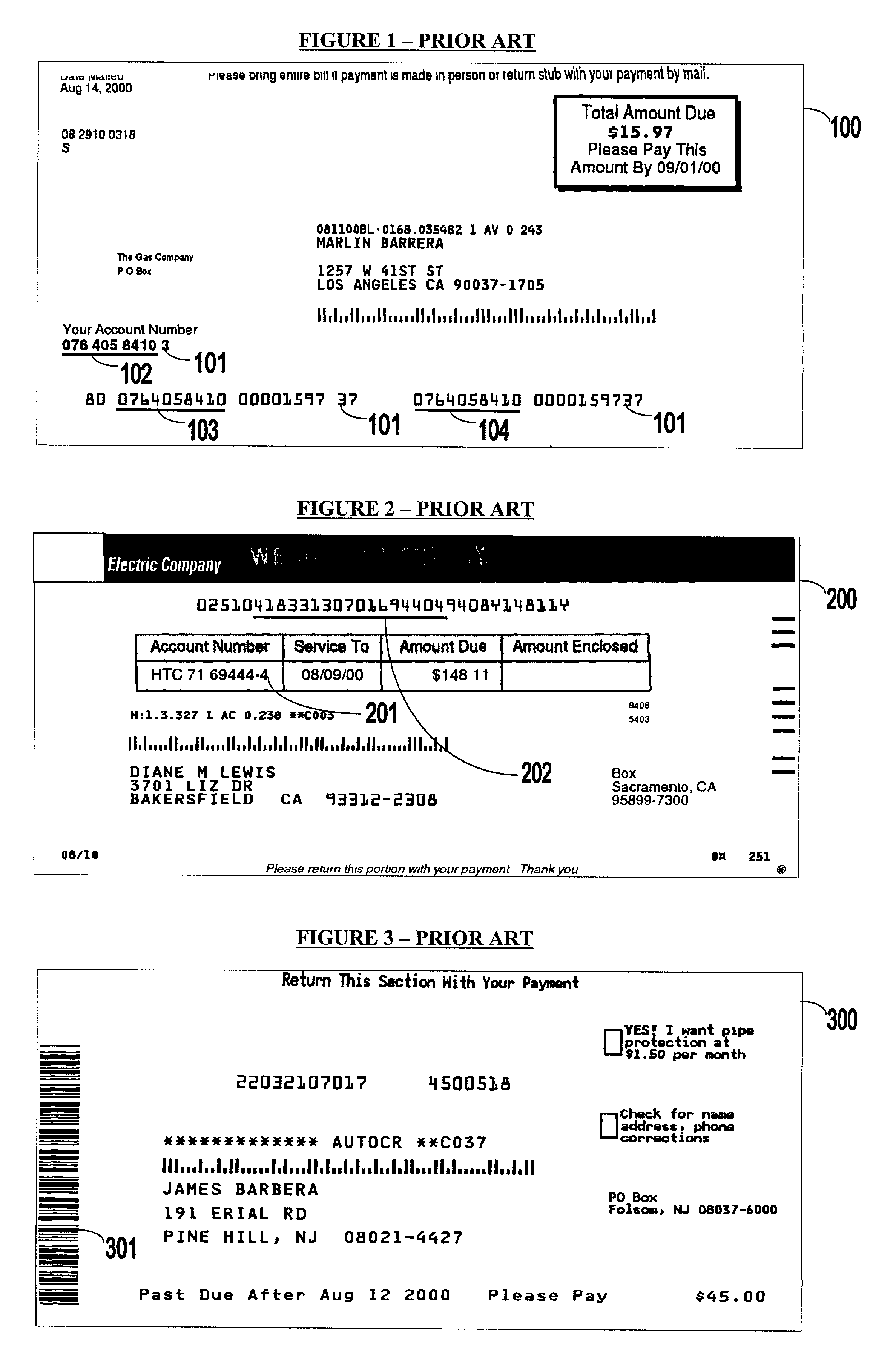

A monetary transaction system consistent with the present disclosure comprises a mechanism allowing a biller to generate at least one invoice for at least one customer, where the invoice contains a unique bar code, comprising data identifying at least the customer and the biller, and a scanning apparatus and associated components, for use by a third party, configured both to scan the bar code and, based on the identifying data of the bar code, to effect payment to the biller in a predetermined or customer-specified amount. In method form, a bill payment method consistent with the disclosure comprises: generating a biller invoice for at least one customer, said invoice containing a unique bar code, said bar code comprising data identifying at least said customer and said biller; and enabling a third party to scan and process said bar code and, based on the identifying data of said bar code, to effect payment to said biller in a predetermined or customer-specified amount. In another embodiment, a bill payment system consistent with the disclosure comprises mechanisms allowing a plurality of billers to generate bar coded invoices, with each biller generating an invoice for at least one customer, the invoice comprising a unique bar code comprising data identifying at least the customer and the biller, and networked mechanisms allowing a plurality of third parties, in communication with said billers, to scan and process a given bar code and, based on the identifying data of said bar code, to effect payment to its associated biller in a predetermined or customer-specified amount.

Owner:PAYSCAN AMERICA

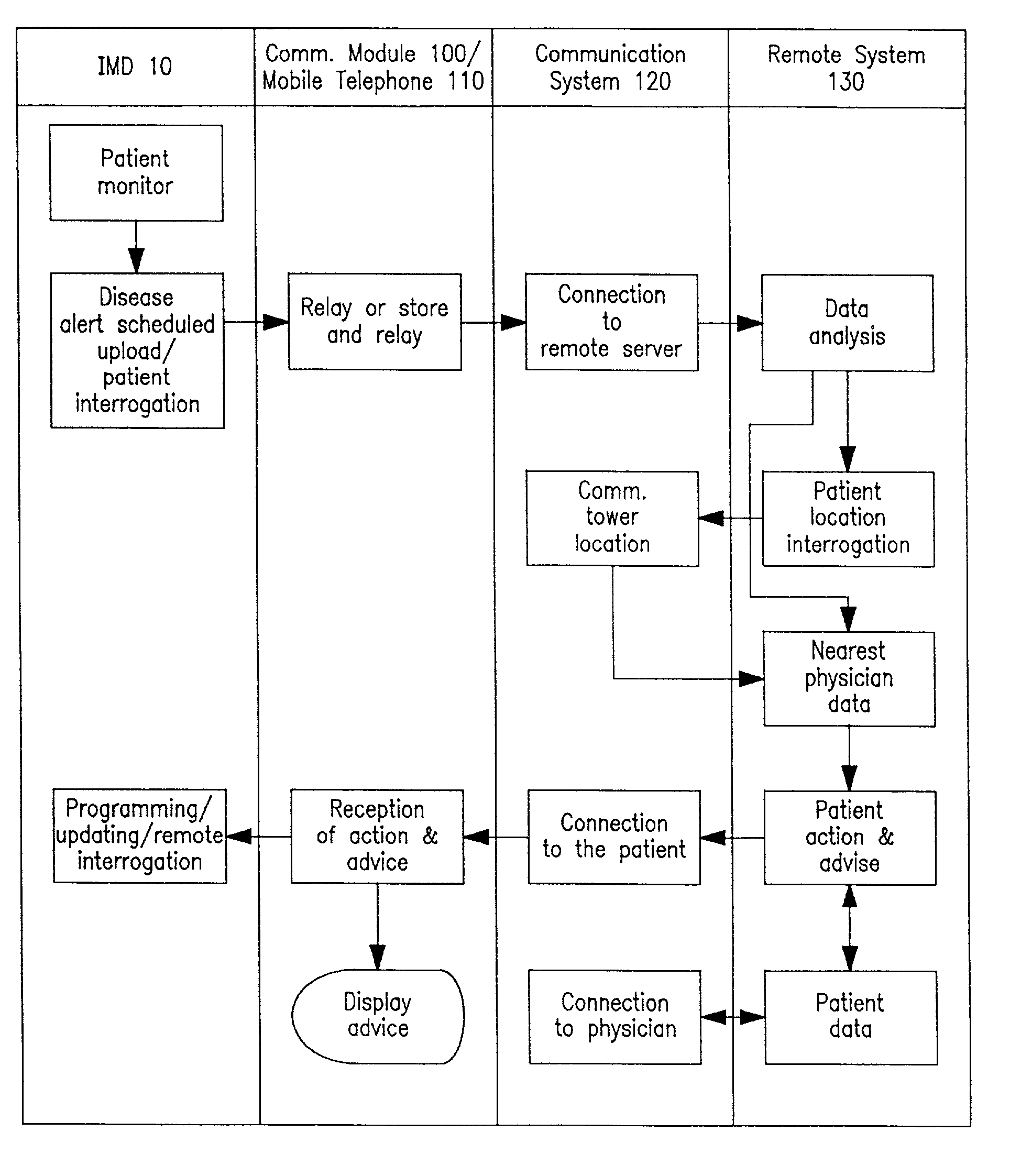

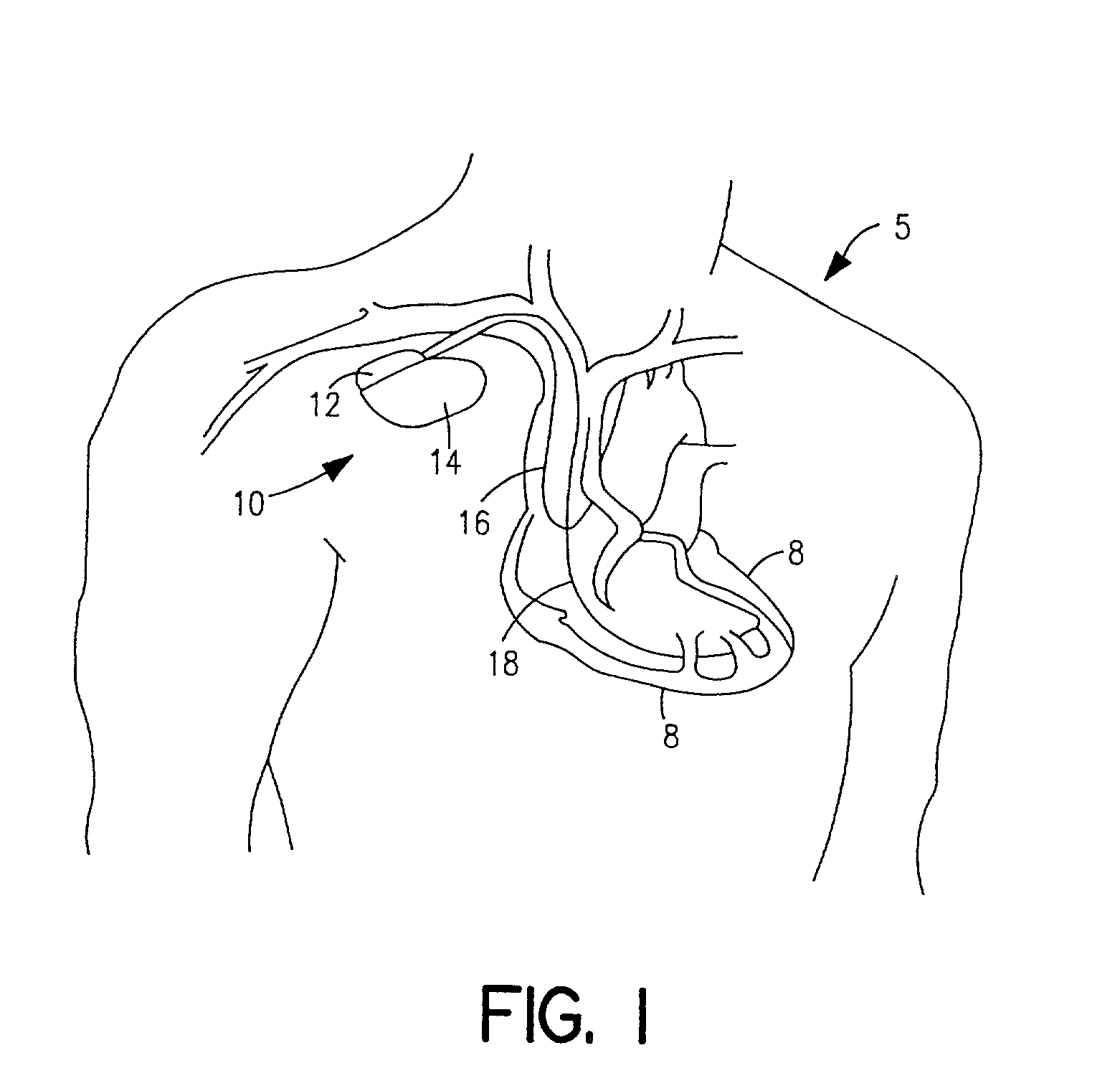

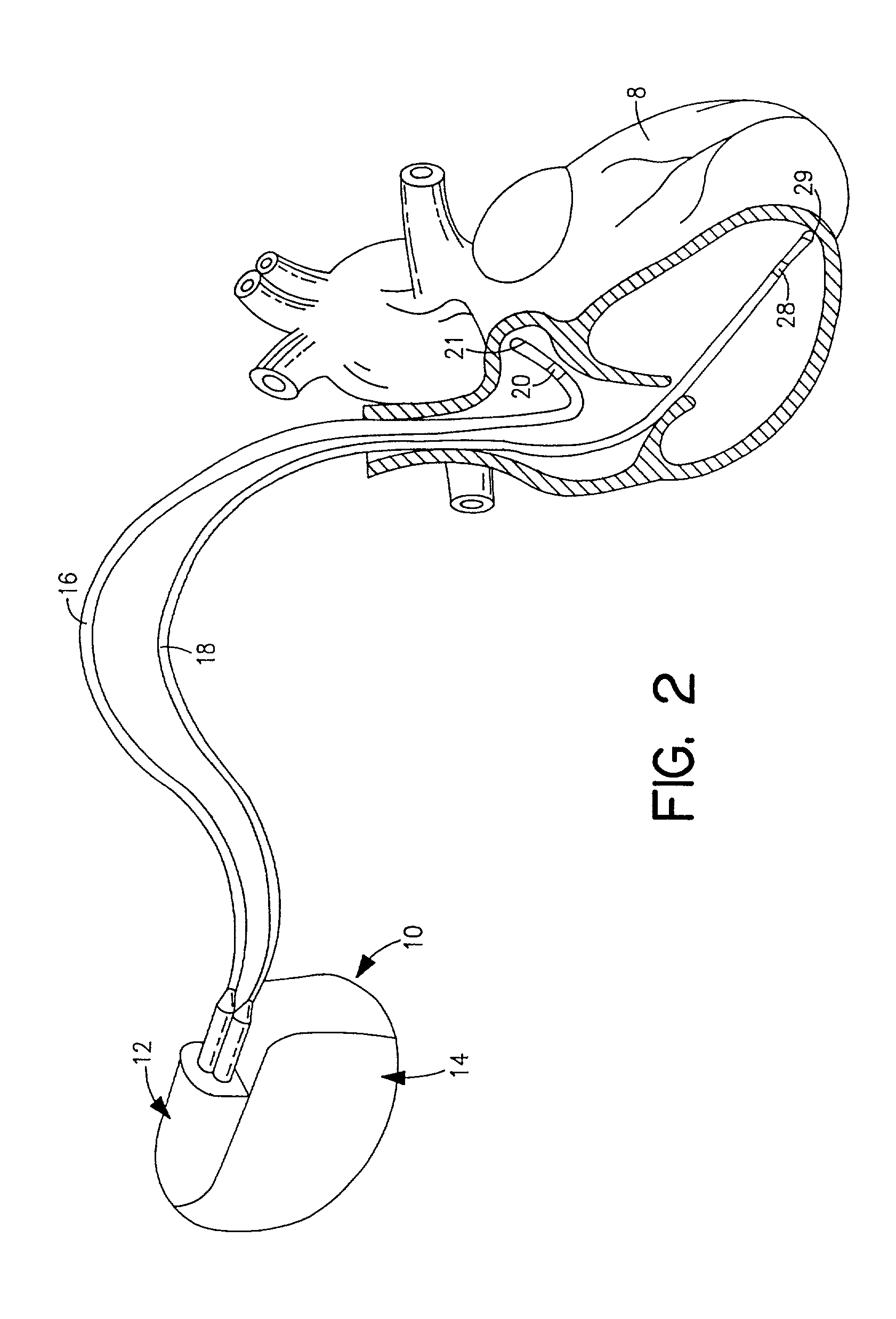

System and method of automated invoicing for communications between an implantable medical device and a remote computer system or health care provider

InactiveUS7149773B2Low costQuickly download new softwareElectrotherapyData processing applicationsComputer moduleInvoice

Methods, devices and systems for automatically generating invoices when medical services are provided to a patient are described. Invoices are automatically generated by the system, for example, when monitoring of certain aspects of the performance of an implantable medical device(IMD) implanted within a body of a patient is initiated by the patient or remotely, or when the delivery of a therapy to the patient through the IMD is initiated locally or remotely. The IMD is capable of bi-directional communication with a communication module, a mobile telephone and / or a Personal Data Assistant (PDA) located outside the patient's body. The system invoicing system may comprise the IMD, the communication module and / or a mobile telephone and / or a PDA, means for generating an invoice, a remote computer system, and a communication system capable of bi-directional communication, where the communication module, the mobile telephone and / or the PDA is capable of receiving information from the IMD or relaying information thereto.

Owner:BELLTOWER ASSOC

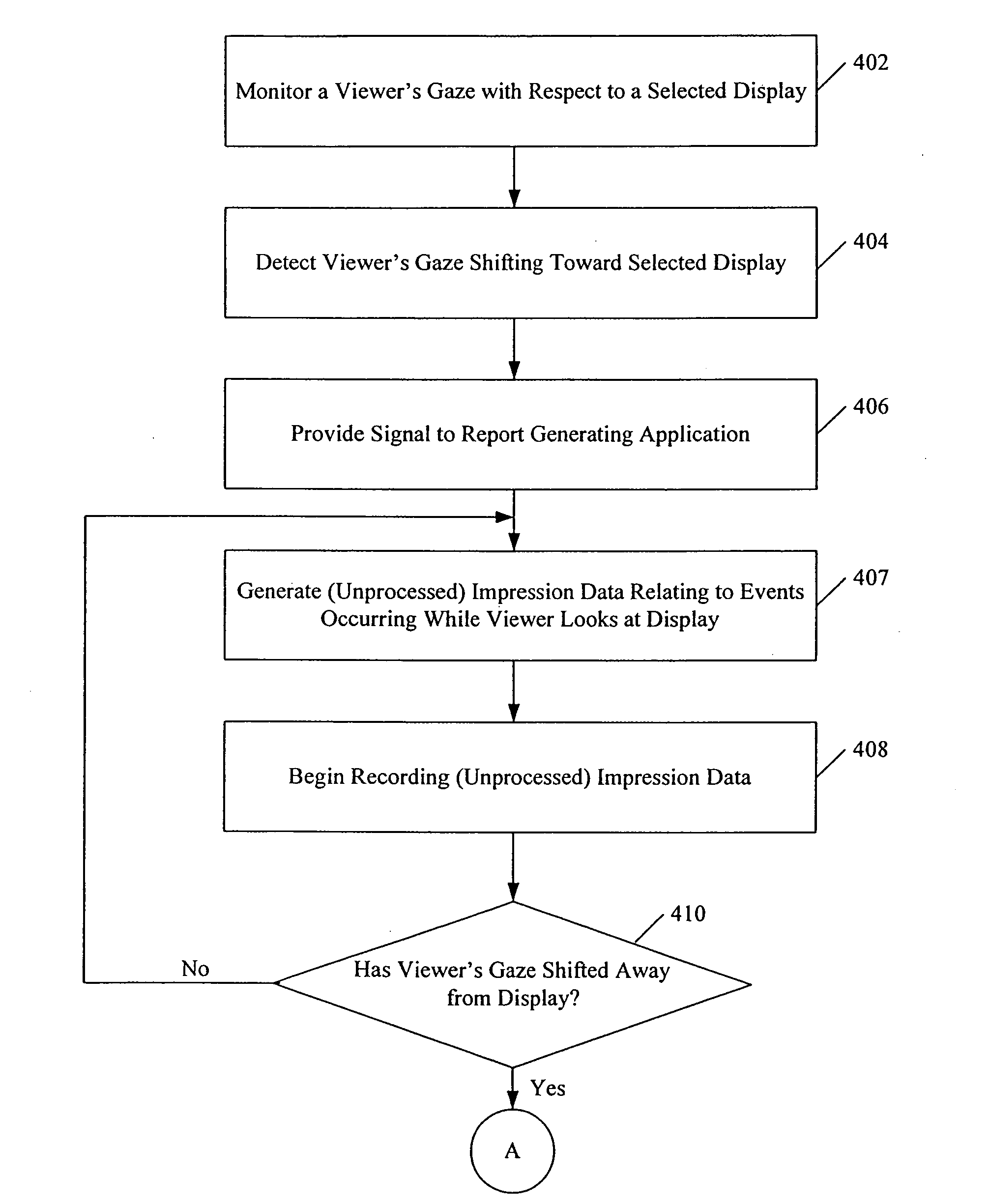

System and method for monitoring viewer attention with respect to a display and determining associated charges

InactiveUS20080147488A1Enhance advertising campaignIncrease salesComplete banking machinesAdvertisementsInvoiceDisplay device

In an example of an embodiment of the invention, data relating to at least one impression of at least one person with respect to a display is detected, and a party associated with the display is charged an amount based at least in part on the data. The at least one impression may include an action of the person with respect to the display. The action may comprise a gaze, for example, and the method may comprise detecting the gaze of the person directed toward the display. The person's gaze may be detected by a sensor, for example, which may comprise a video camera. An invoice may be generated based at least in part on the data, and sent to a selected party. The display may comprise one or more advertisements, for example. A face monitoring update method is also disclosed. Systems are also disclosed.

Owner:STUDIO IMC

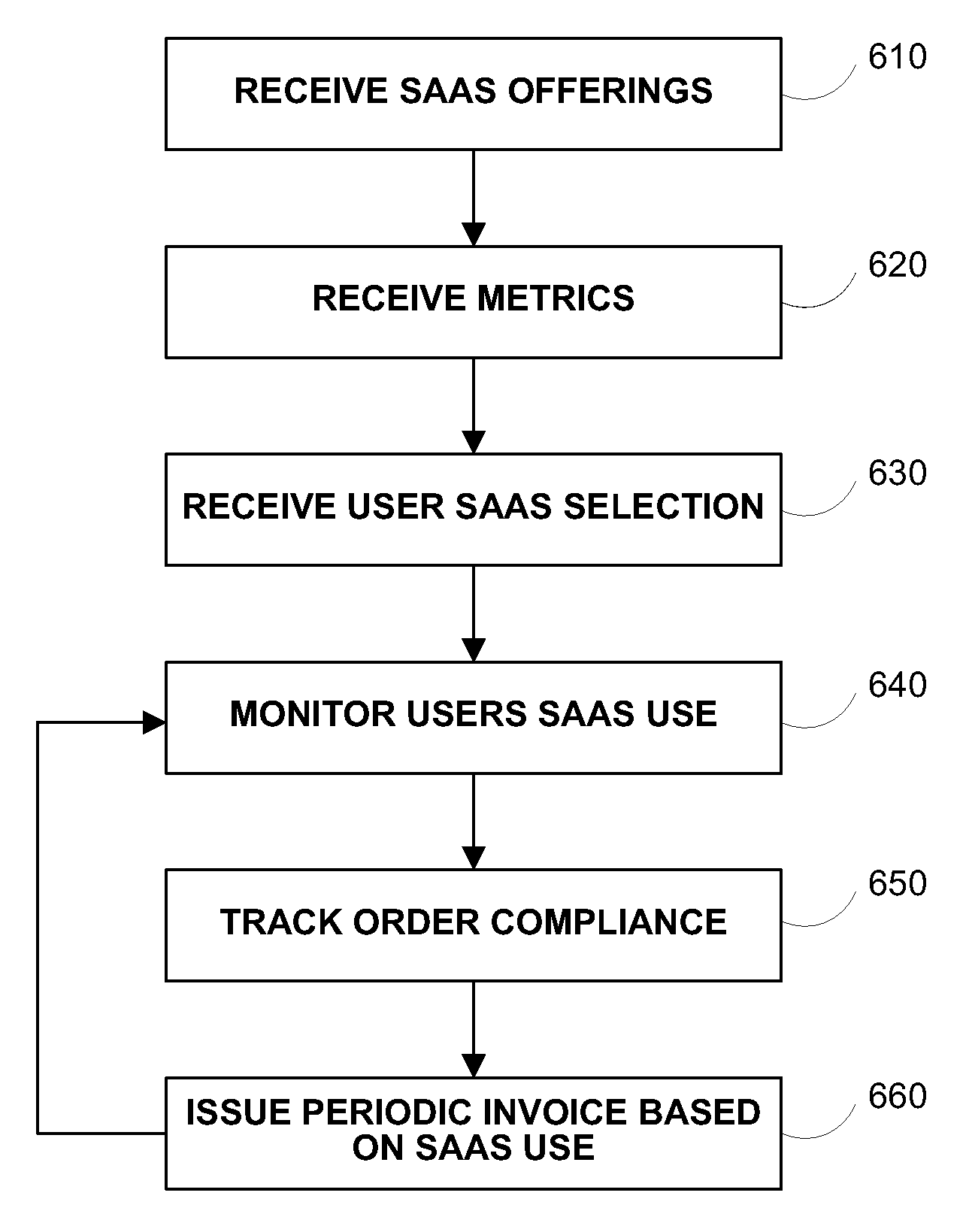

Systems and methods for metered software as a service

InactiveUS20090271324A1Good serviceComplete banking machinesError detection/correctionPaymentInvoice

Systems and methods are provided for facilitating software as a service (SAAS) by receiving information of SAAS offerings and metrics for tracking a users use of the SAAS offerings. The systems may be used to create SAAS orders and provide compliance and auditing of the SAAS, as well as generating invoices and receiving payment for the SAAS.

Owner:EVAPT

Player Wagering Account and Methods Thereof

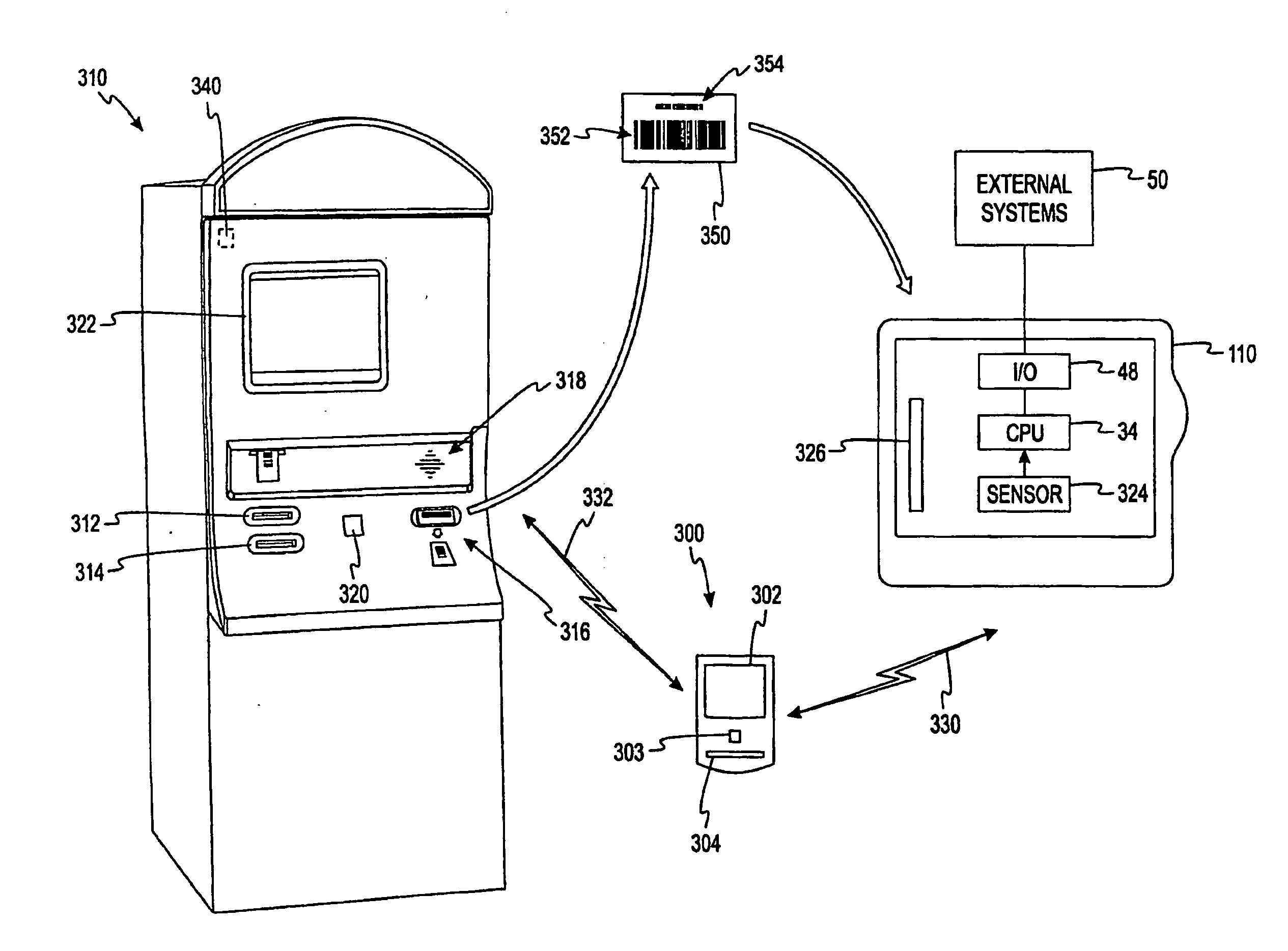

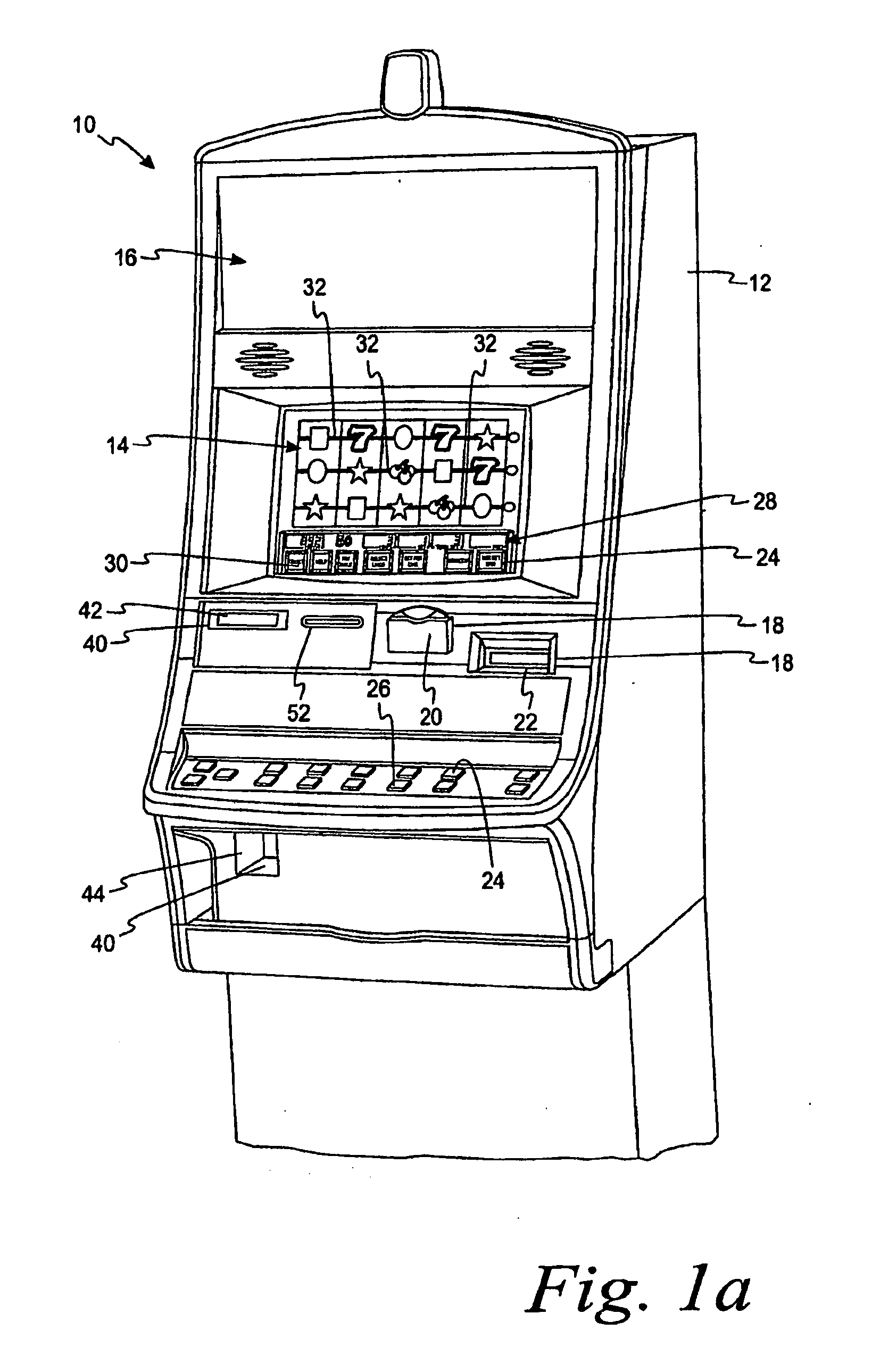

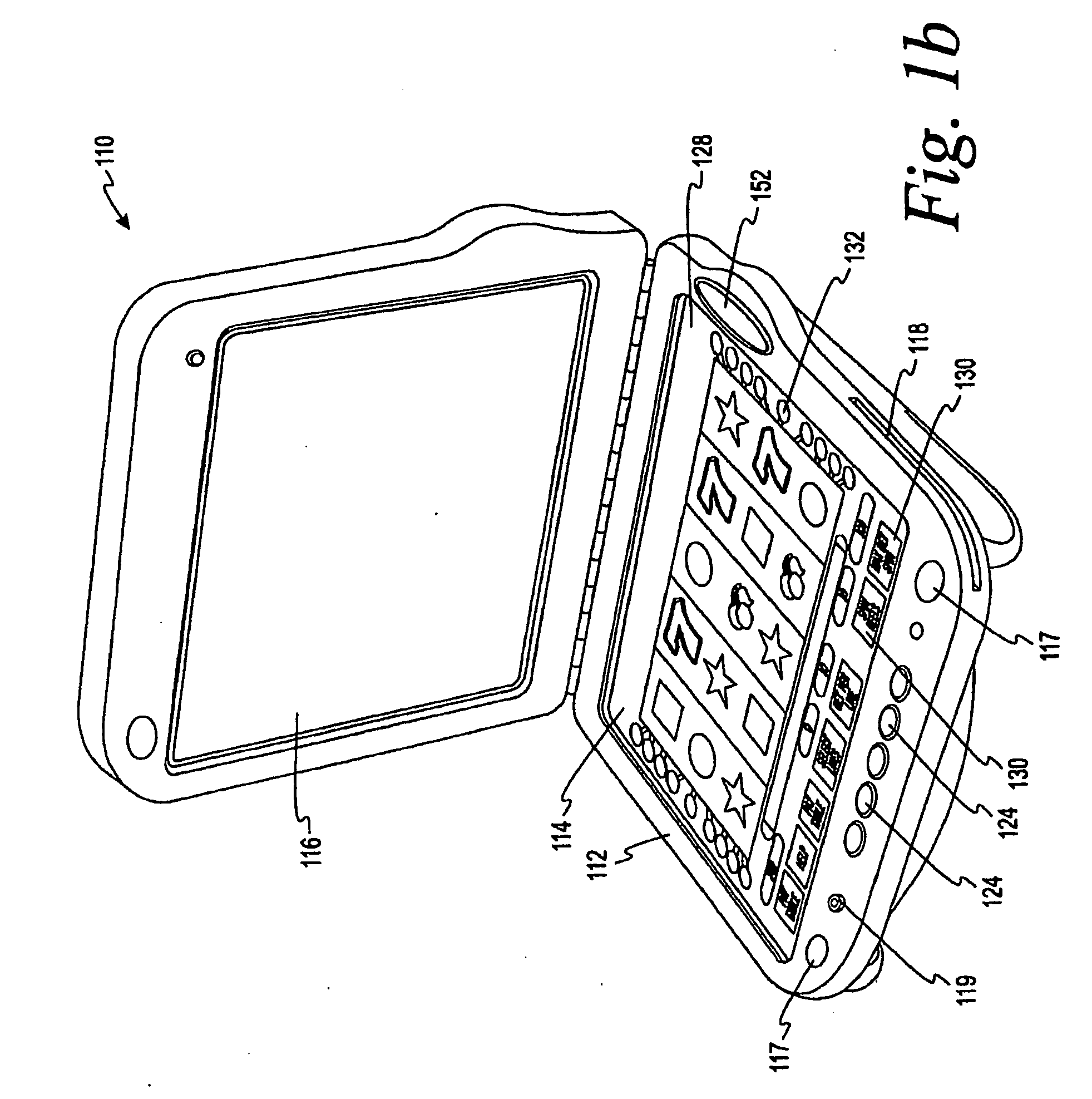

ActiveUS20100227670A1Improve balanceCard gamesApparatus for meter-controlled dispensingInvoiceEngineering

A system for adding funds to a handheld gaming machine. The system includes a portable digital wallet that wirelessly communicates with a handheld gaming machine (“handheld”). The digital wallet stores an amount of funds or funds associated with a remotely stored player account, and is used by the player to add credits to a handheld. The credit meter may be stored remotely, though the player perceives that the funds are actually being transferred via the digital wallet. Other funding techniques include a kiosk that accepts cash or credit / debit cards and dispenses tickets or other media that encodes information representing an amount of funds. The player uses this media to add credits to the handheld. The media may be player-dependent such that the player's identity is somehow linked to the media or it may be player-agnostic such that the player's identity is not linked to the funds associated with the media.

Owner:LNW GAMING INC

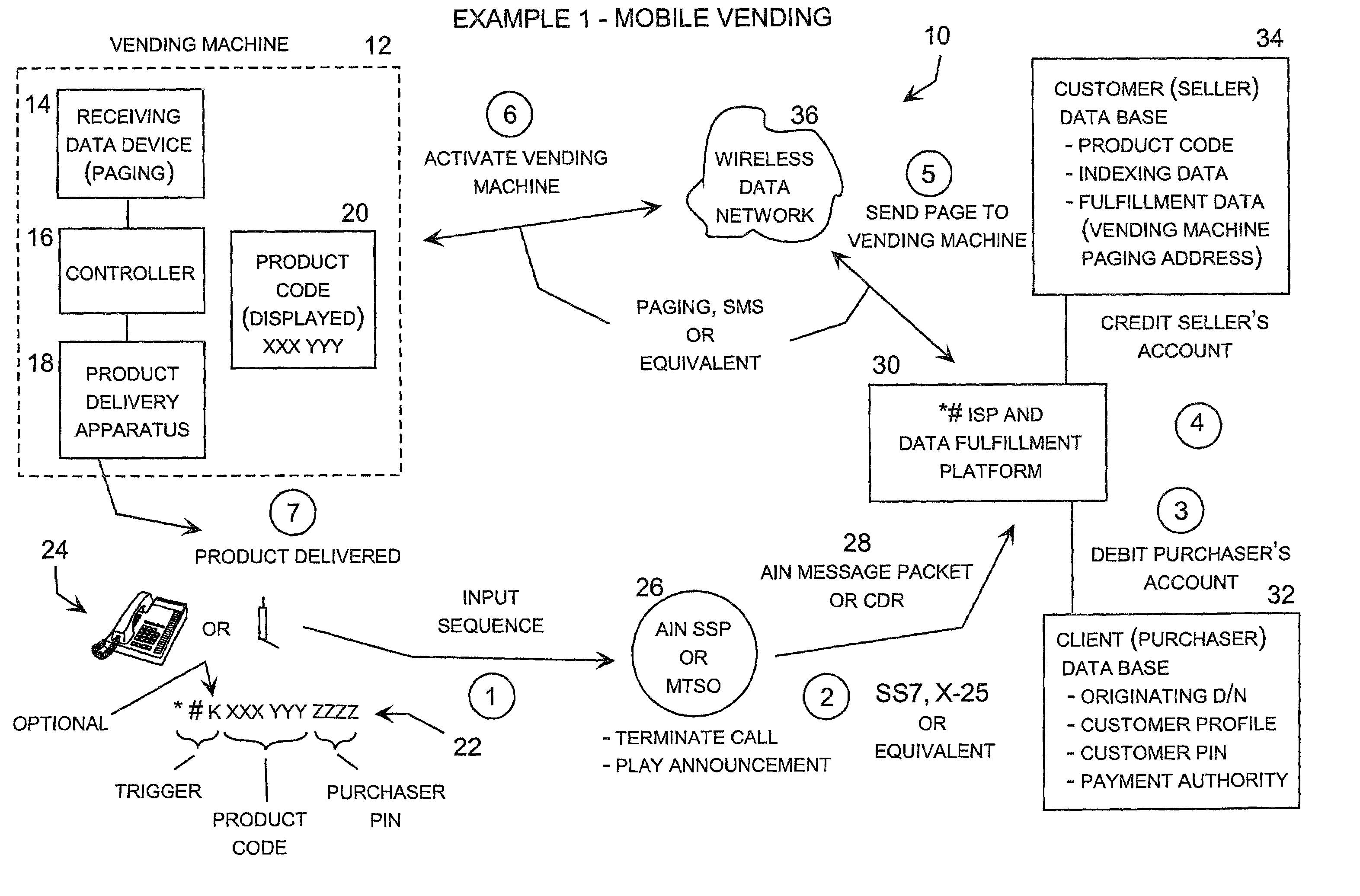

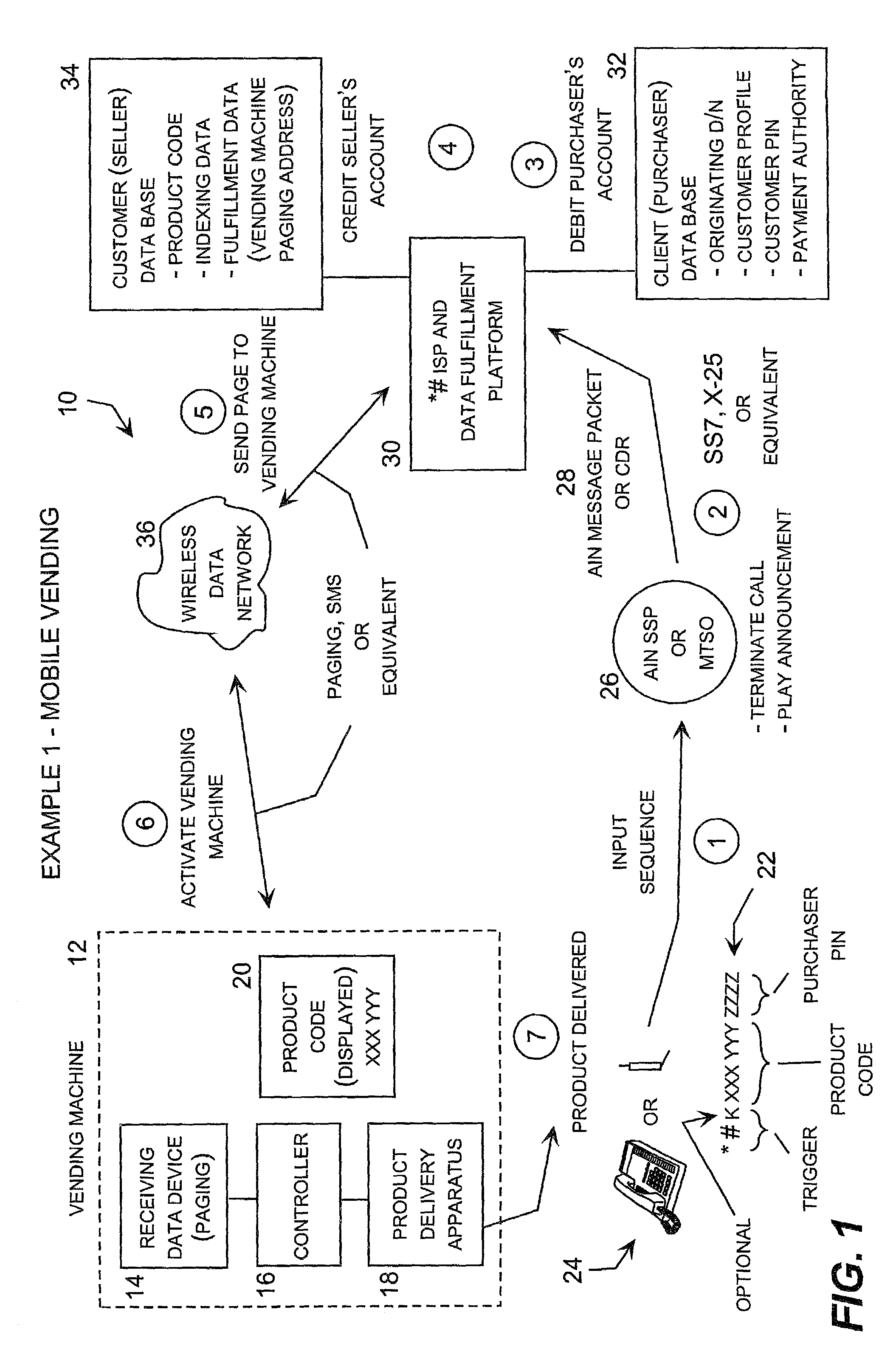

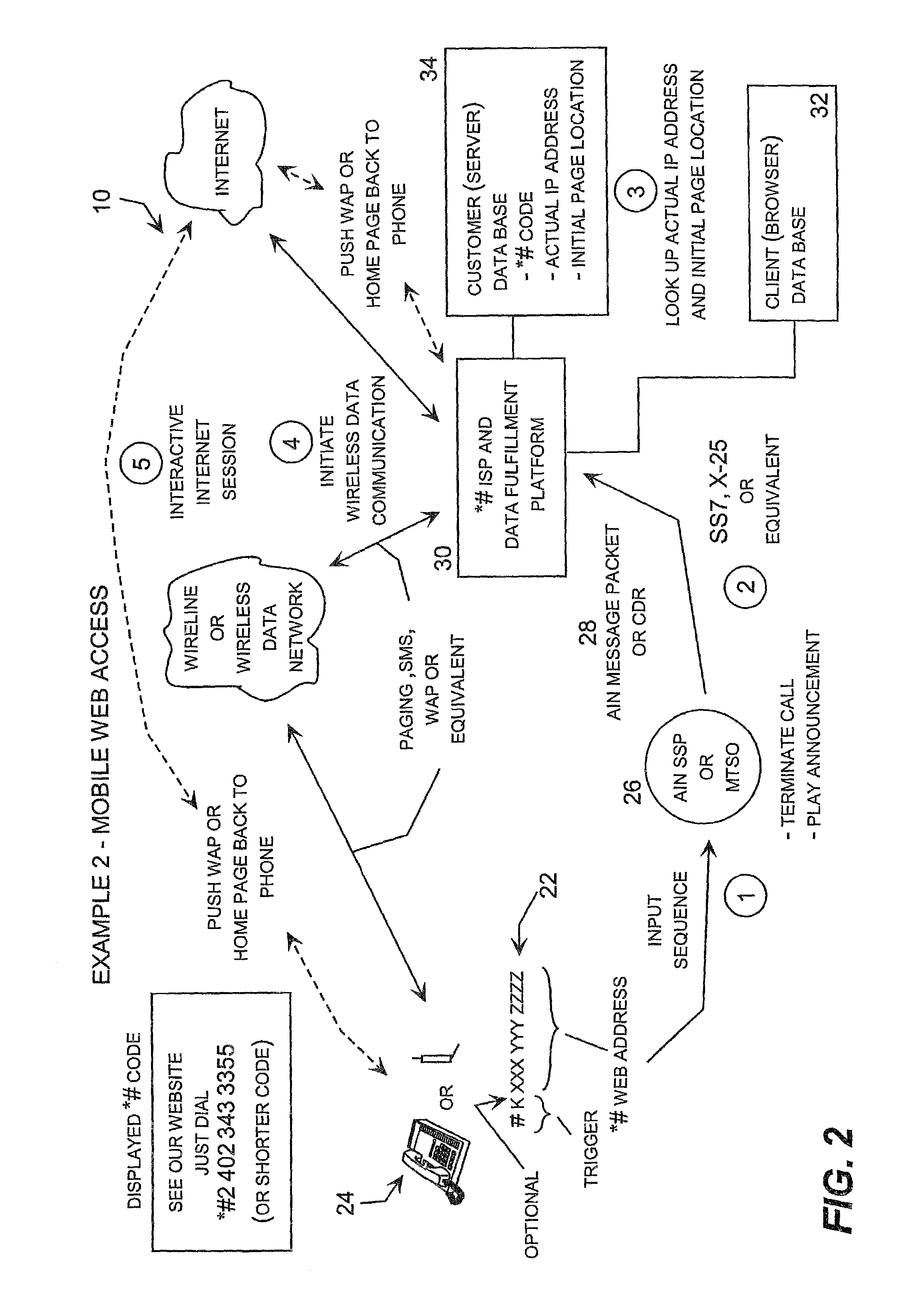

Telecommunications initiated data fulfillment system

InactiveUS6990472B2Allow reuseHighly integratedDiscounts/incentivesTelephonic communicationWireless dataThe Internet

A system for providing a wide range of telecommunications initiated data fulfillment services in which a multi-function code, such as “*#” (star, pound), input into an originating telecommunications device, such as a conventional land-line or wireless telephone, triggers the treatment of the input sequence as a multi-function code service request rather than a dialed directory number. The multi-function code is followed by an input data string to complete the multi-function code service request, which the user typically enters into the telecommunications device just like a conventional telephone call, except that the input string begins with the multi-function code. The telecommunications system recognizes the multi-function code as a trigger, and in response takes one or more actions, such as automatically terminating the call to an announcement and routing a data message to a data fulfillment center, which responds to the message by implementing a response action indicated by the multi-function code service request. For example, the data fulfillment center may respond by transmitting a message over a wireless data network or the Internet to implement a service, such as activation of a vending machine, remote control of device, delivery of a message over the Internet or wireless data network, initiation of an interactive Internet session with the originating device, or a wide range of other services. In addition, a charge for this service may be automatically charged to an account associated with the originating telecommunications device, which may be billed separately or incorporated on the user's conventional monthly telecommunications invoice.

Owner:STARPOUND

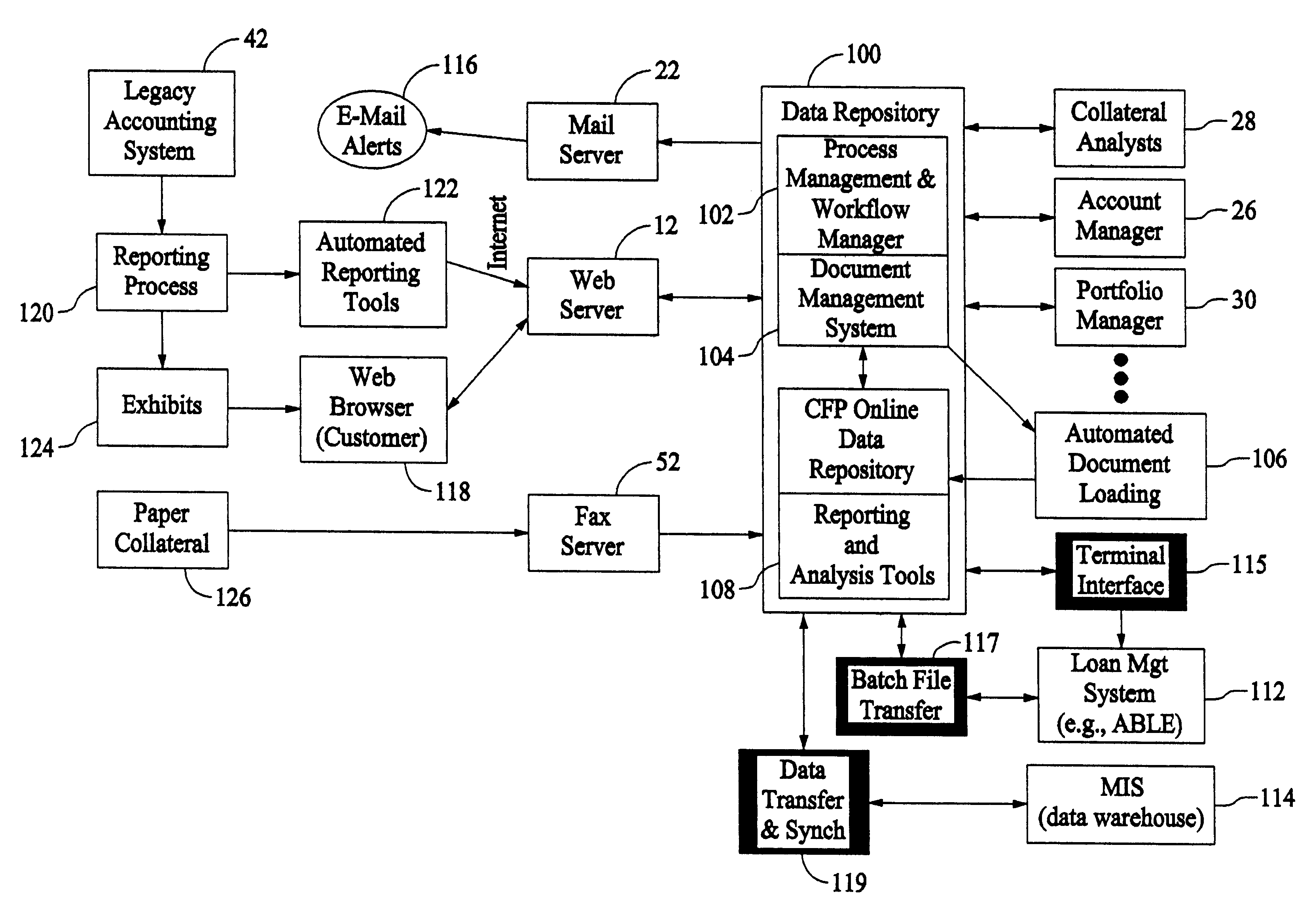

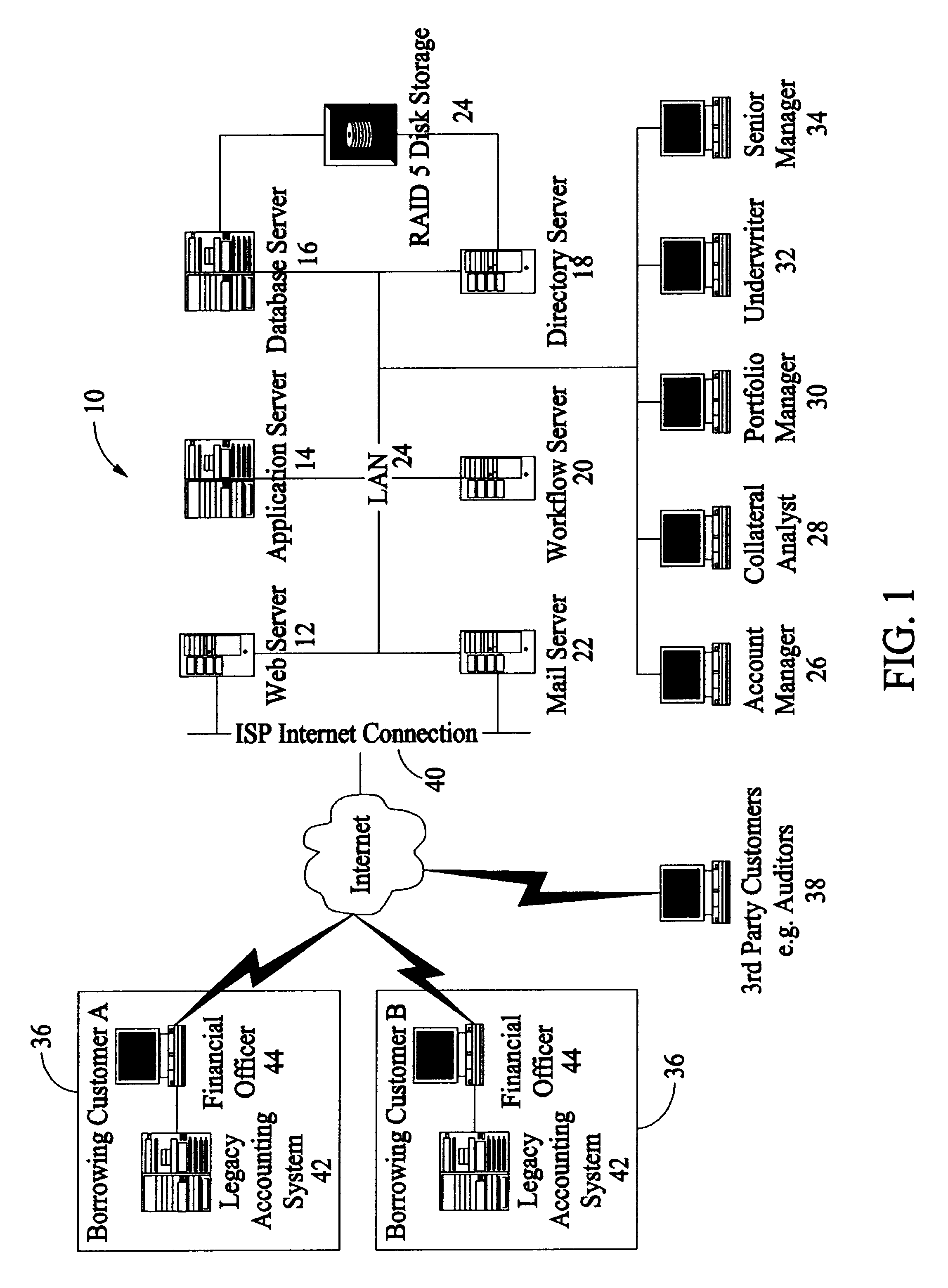

Methods and apparatus for collateral risk monitoring

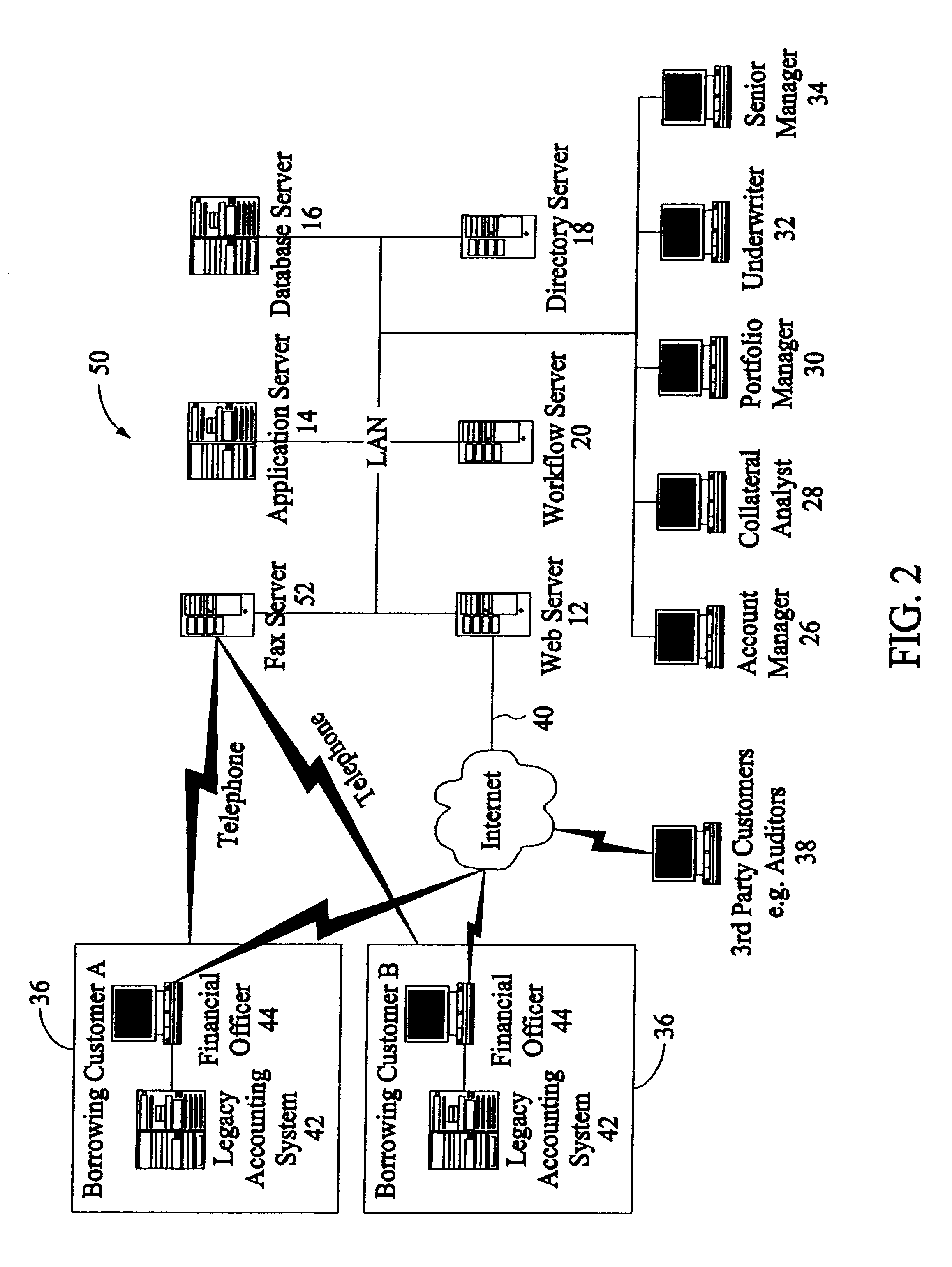

Methods and Apparatus for monitoring collateral risk are described. In one embodiment, the method includes monitoring, for example, accounts receivable, accounts payable, inventory, trading partners, chart of accounts, invoices, and / or payments of a client using a process management and workflow system coupled to a data repository. Specifically, and in an exemplary embodiment, the method includes receiving financial information, extracting data from the financial information, evaluating current collateral information based on the data, and evaluating current credit status.

Owner:GENERAL ELECTRIC CO

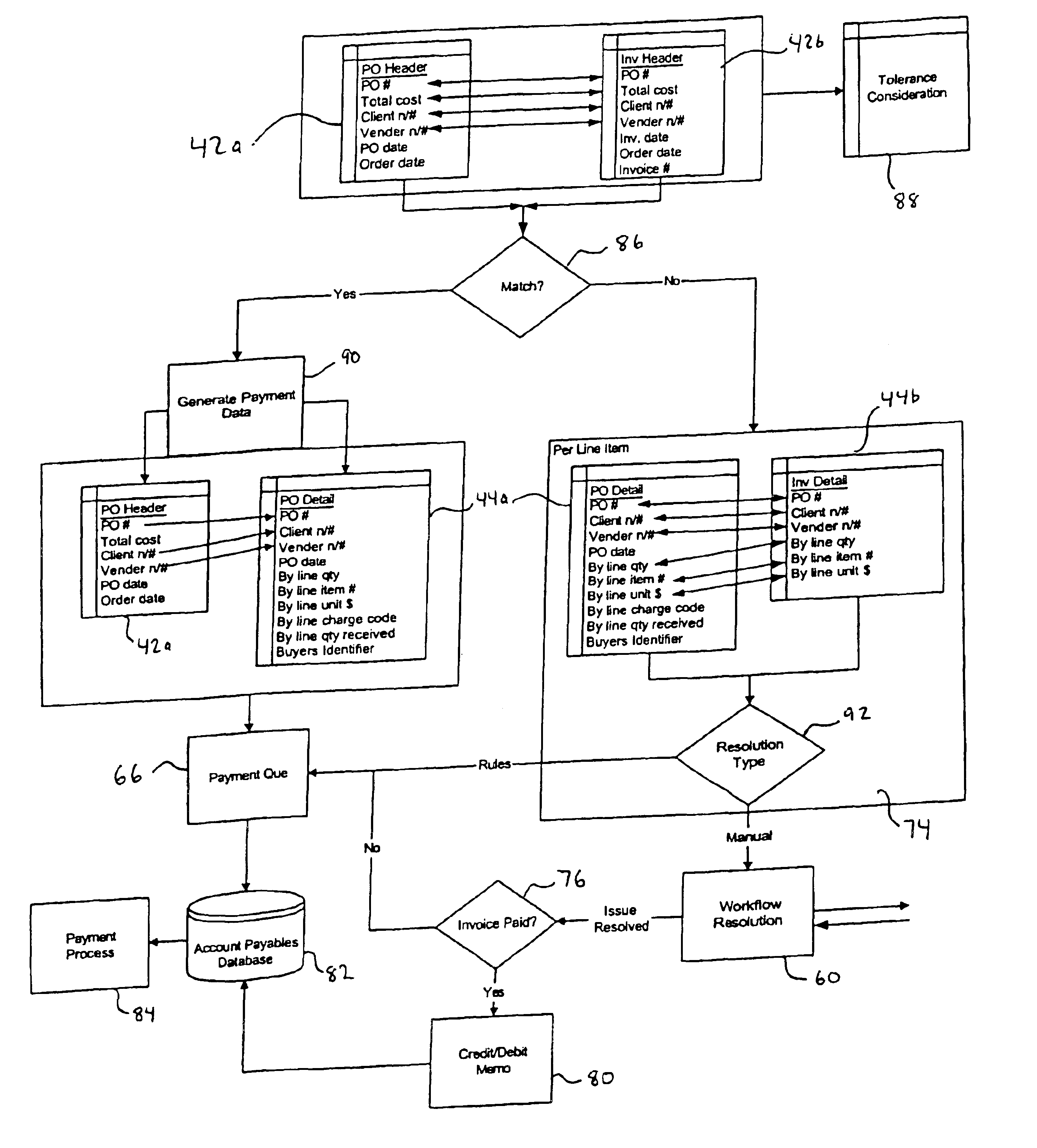

Method and system for processing transactions

InactiveUS6882983B2Minimize resource requirementFurther efficiencyComplete banking machinesFinancePaymentInvoice

The present invention discloses a system and method for processing business transactions between trading partners using a central interactive platform. The processing may include comparing purchase order data and invoice data to identify matching information and non-matching information. If the information matches, the invoices are processed for payment. If the information does not match, the discrepancies are identified to the buying company or the selling company for resolution.

Owner:ORACLE INT CORP

System and method for payer (buyer) defined electronic invoice exchange

A method of implementing buyer and seller transactions is provided. A set of rules for accepting information into a document is received from the buyer. Also defined is the form of the presentation of an interface to the seller for creating the seller's invoice. The seller also receives address information from the buyer. The rules for accepting information, the rules regarding presentation and the address information are stored in a storage resource. The rules regarding presentation are accessed from the storage resource, and an interface is presented to the seller based on those rules. The rules for accepting information are accessed from the storage resource, and information for the document based on those rules is accepted through the interface. The address information is accessed from the storage resource, and the document with the accepted information is sent to the buyer.

Owner:JPMORGAN CHASE BANK NA

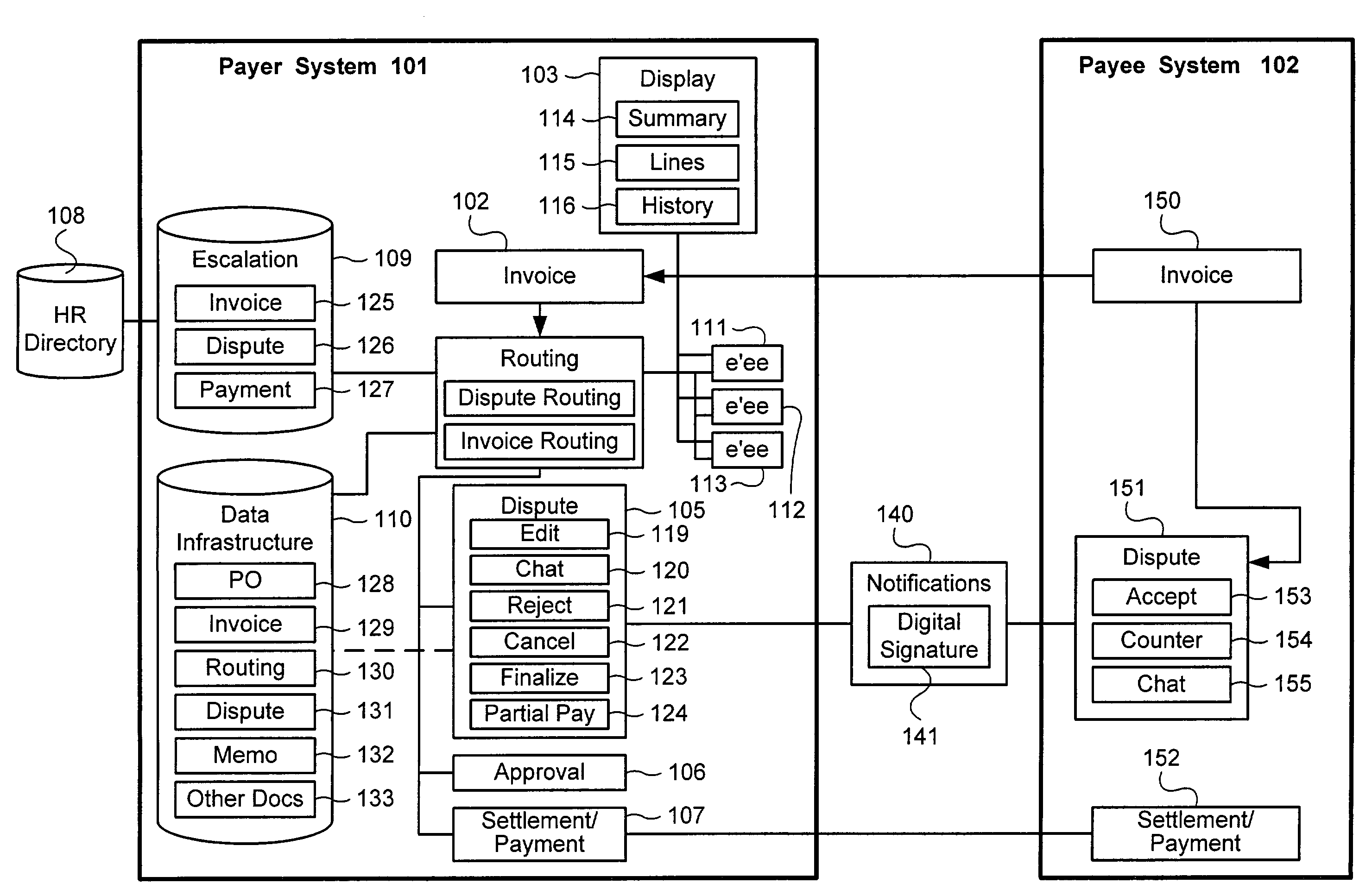

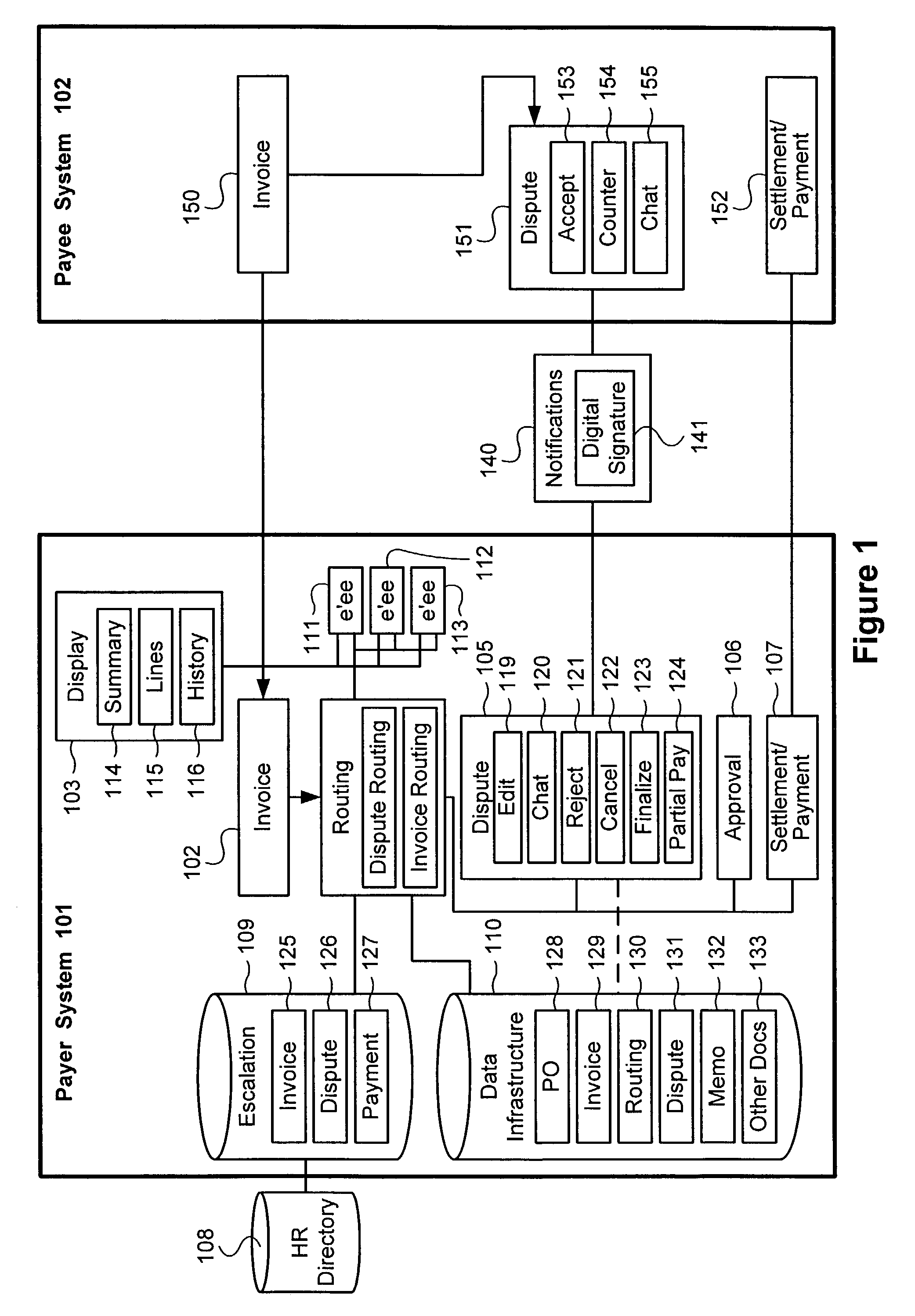

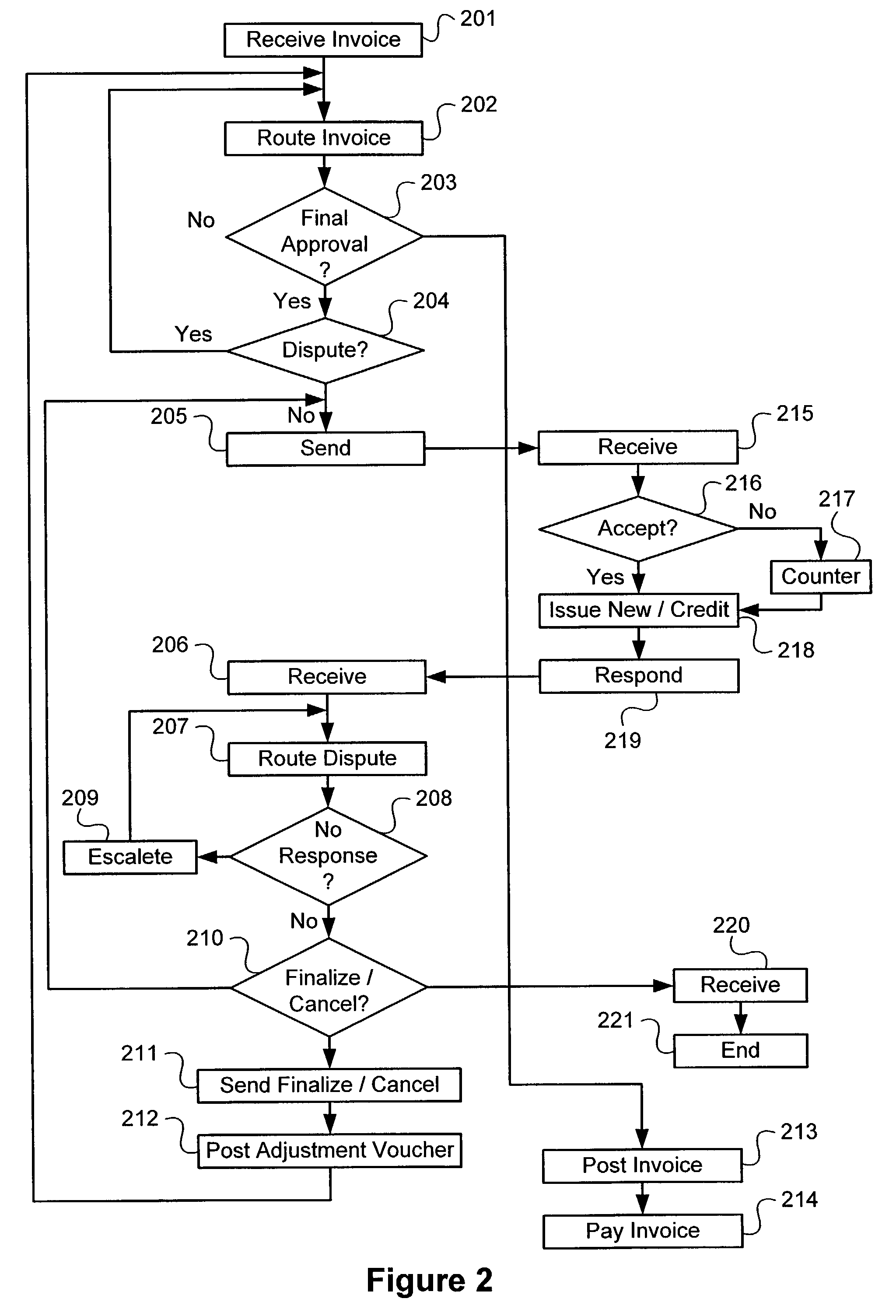

Method and system for buyer centric dispute resolution in electronic payment system

Method of facilitating resolution of a dispute between a buyer and a seller in an electronic payment system. An electronic payment system is also described. An invoice is received from the seller and is electronically routed to the individuals in the buyer's organization. Indications that the invoice is disputed, corrections to the invoice, comments for the seller regarding the invoice and comments for other individuals in the buyer's organization are received from a set of two or more individuals in the buyer's organization. An indication that the invoice is disputed, corrections to the invoice and comments for the seller are forwarded to the seller without forwarding the comments for other individuals in the buyer's organization. A response to the buyer's indication that the invoice is disputed is received from the seller. The response includes an acceptance of changes suggested by the buyer or an indication that the seller disputes the changes suggested by the buyer. Payment is withheld for the invoice until an indication from the buyer has been received that the buyer has determined that the invoice has been paid. The indication, corrections and comments to the seller may be forwarded to the seller in an electronic mail message.

Owner:JPMORGAN CHASE BANK NA

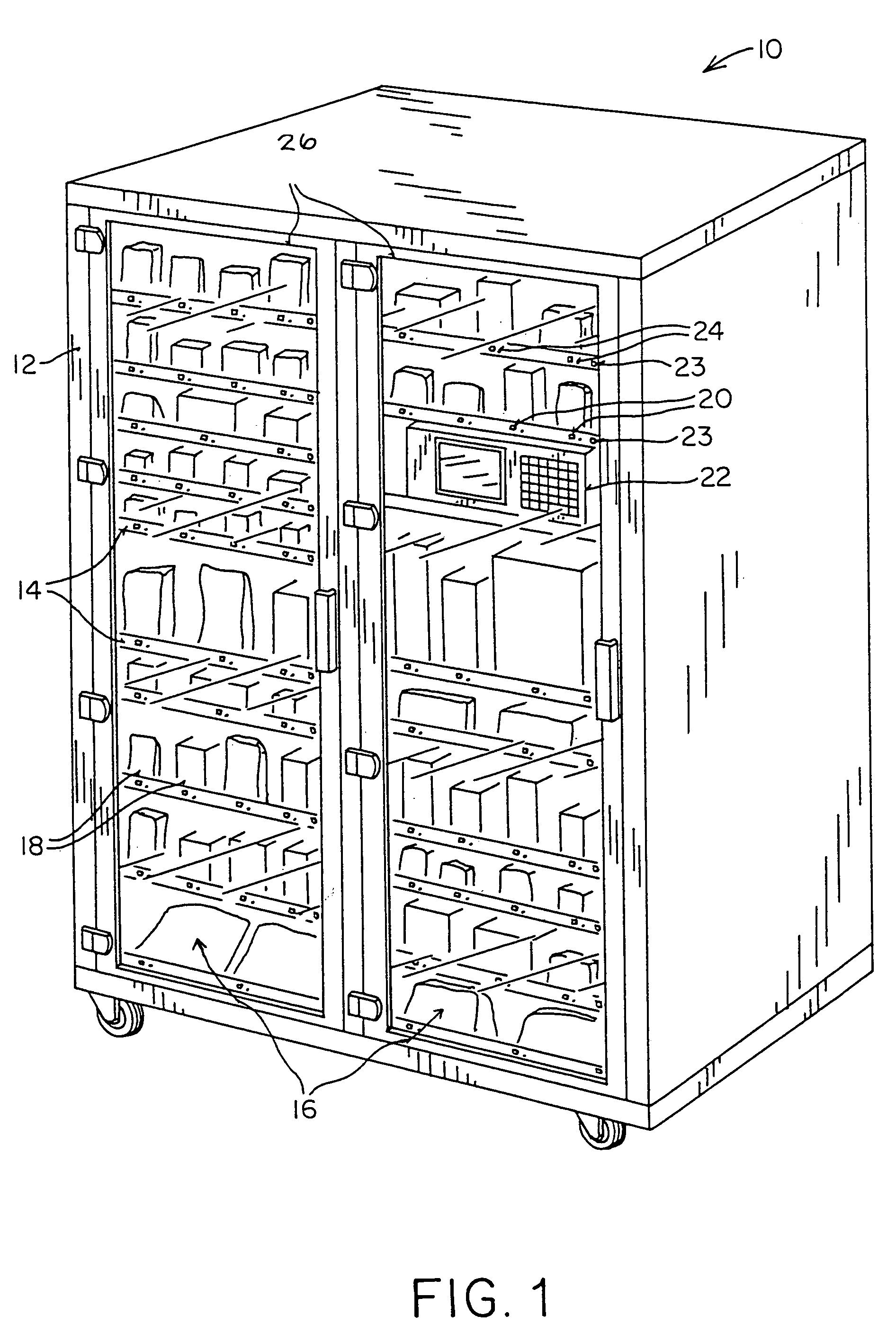

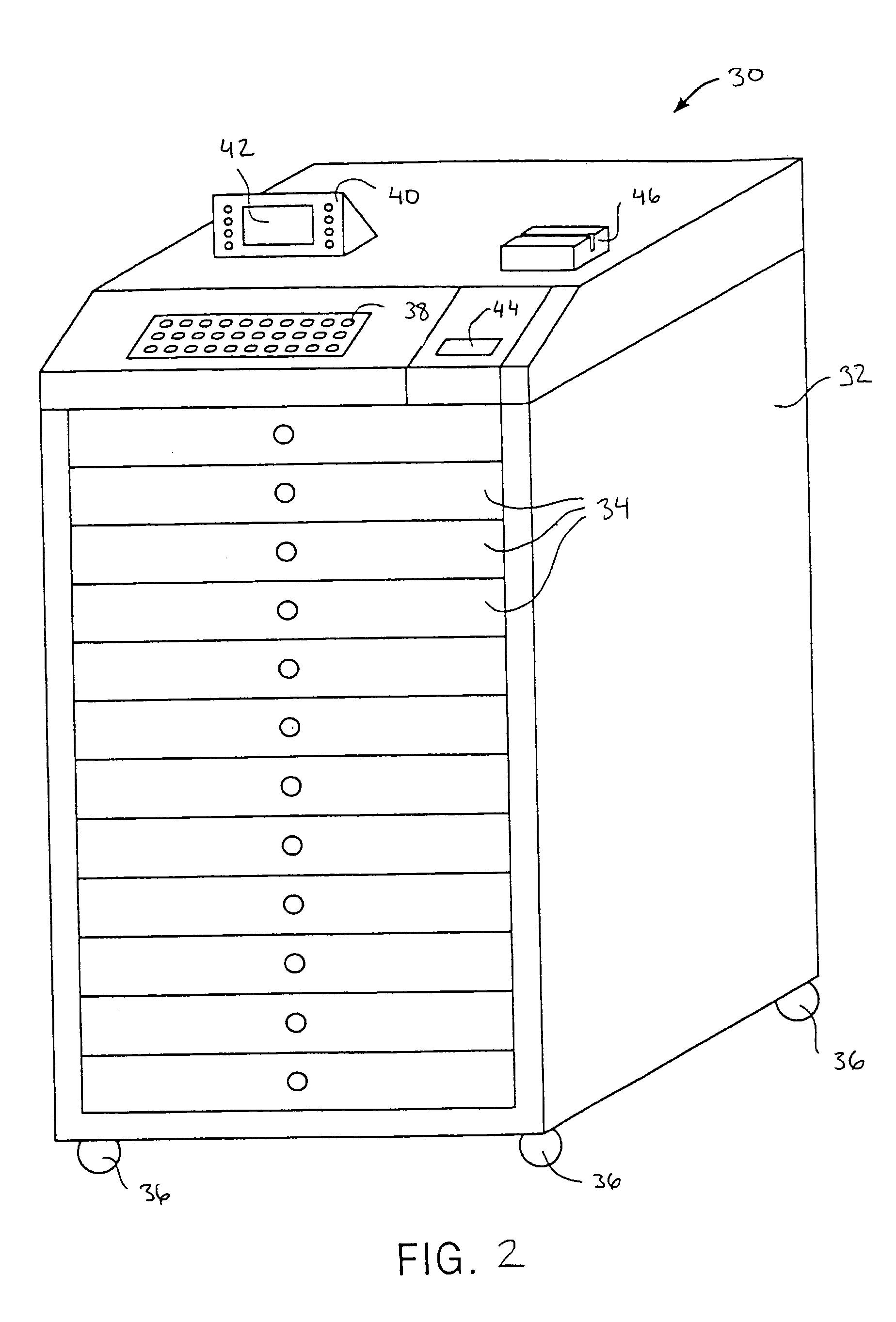

Systems and methods for purchasing, invoicing and distributing items

InactiveUS7072855B1Hand manipulated computer devicesDigital data processing detailsInvoicePurchasing

A method for supplying items to dispensing units that hold at least one type of item and a record of inventory levels comprises periodically sending restocking information from the dispensing units over a network to a server computer. Ordering information is generated for the items to be restocked based on the restocking information. The ordering information is electronically sent to one or more supplier computers to order items to be restocked into the dispensing units.

Owner:NEXIANT

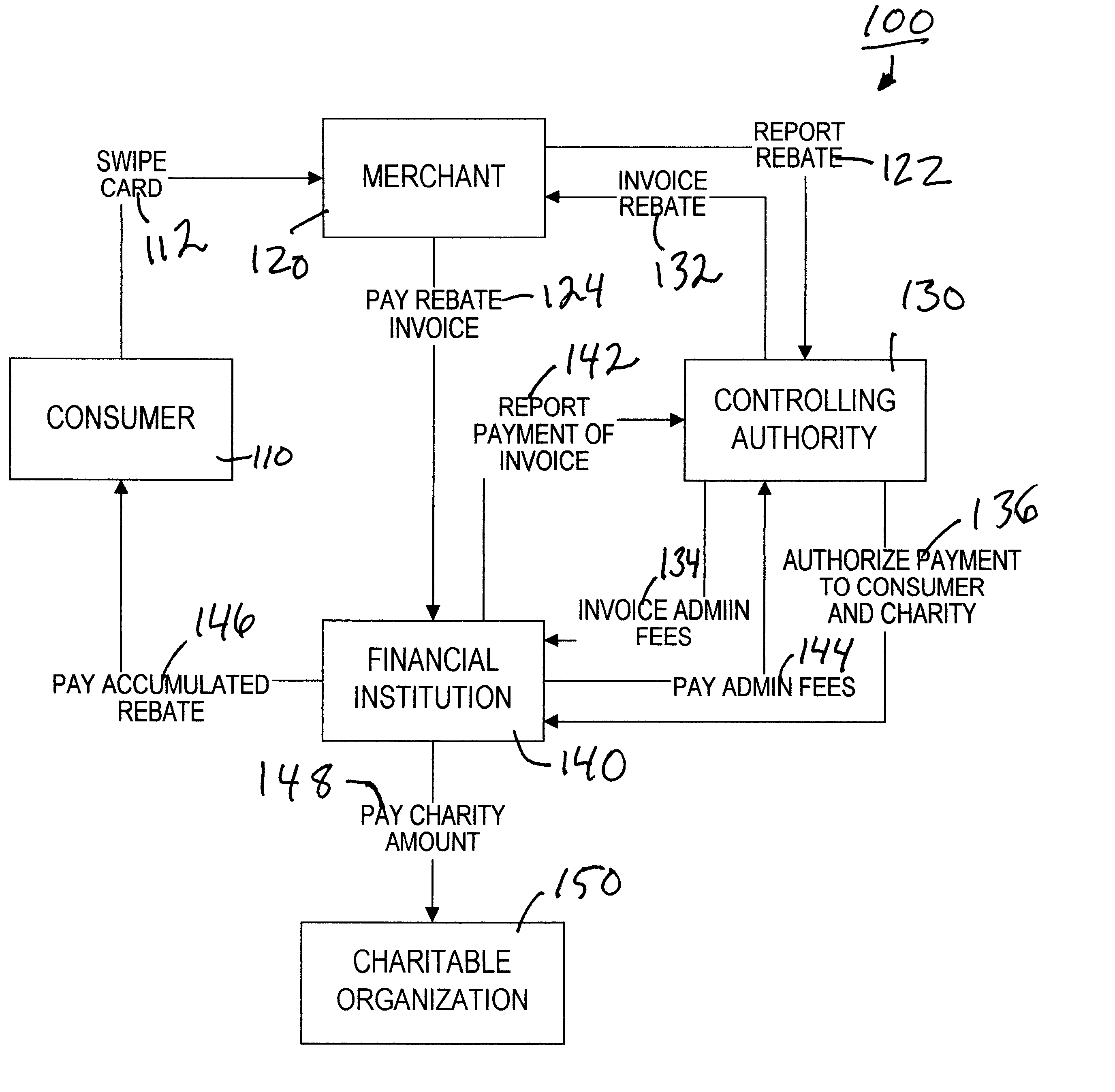

Method of administering a rebate system

In a method of administering a rebate system, rebate-related information is electronically transmitted from a rebate issuing entity and is received by a central processing authority. The rebate-related information includes information identifying a consumer and information relating to a purchase made by the consumer from the rebate issuing entity. The central authority determines an amount of a rebate that is to be credited to the consumer, based on information previously provided by the rebate issuing entity. The rebate issuing entity is invoiced for the amount of the rebate, wherein the amount is payable to an omnibus trust account, wherein a trustee has exclusive control over the omnibus trust account and the trustee is authorized to transfer a credit from the omnibus trust account to the consumer.

Owner:SOURCE

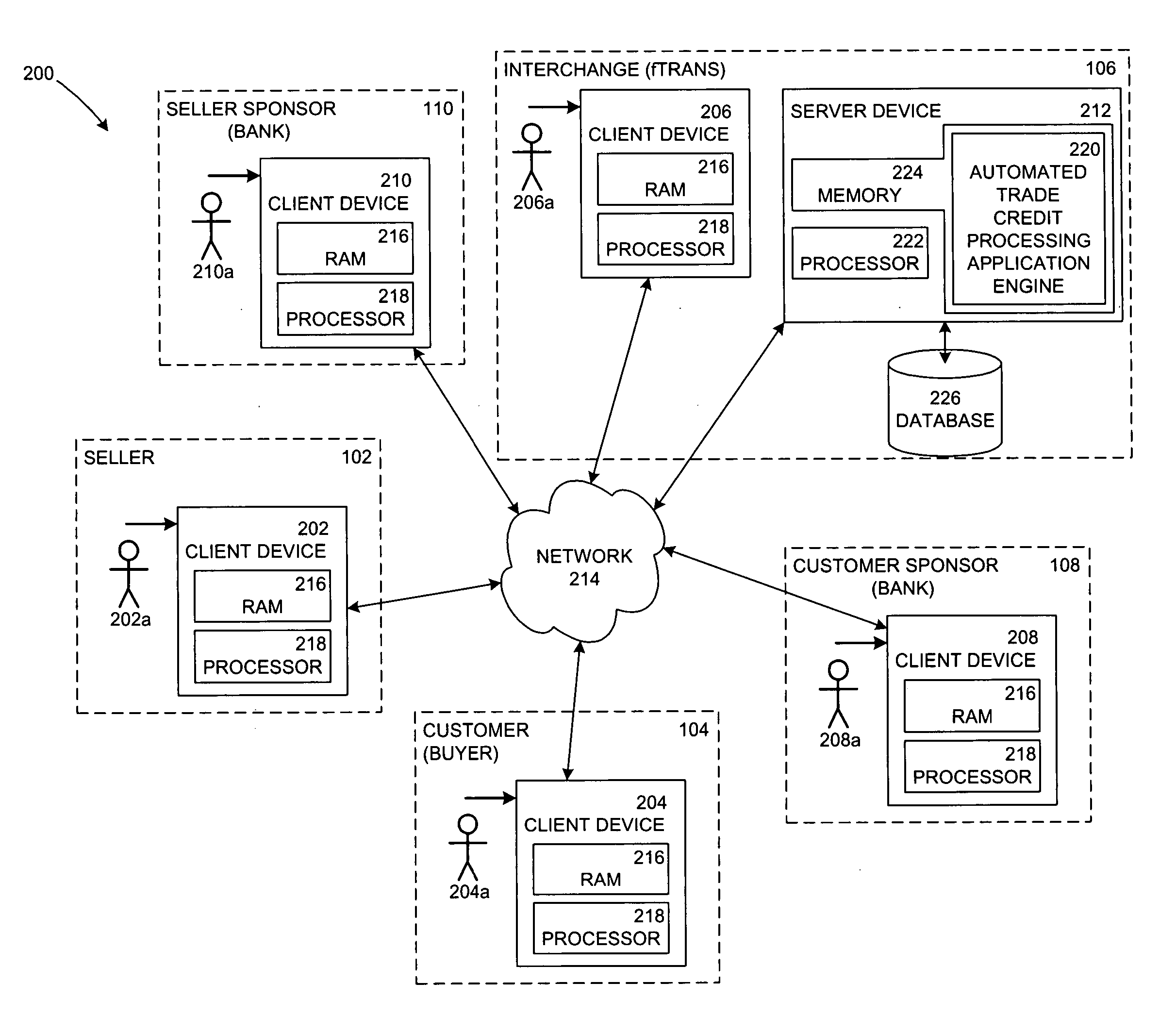

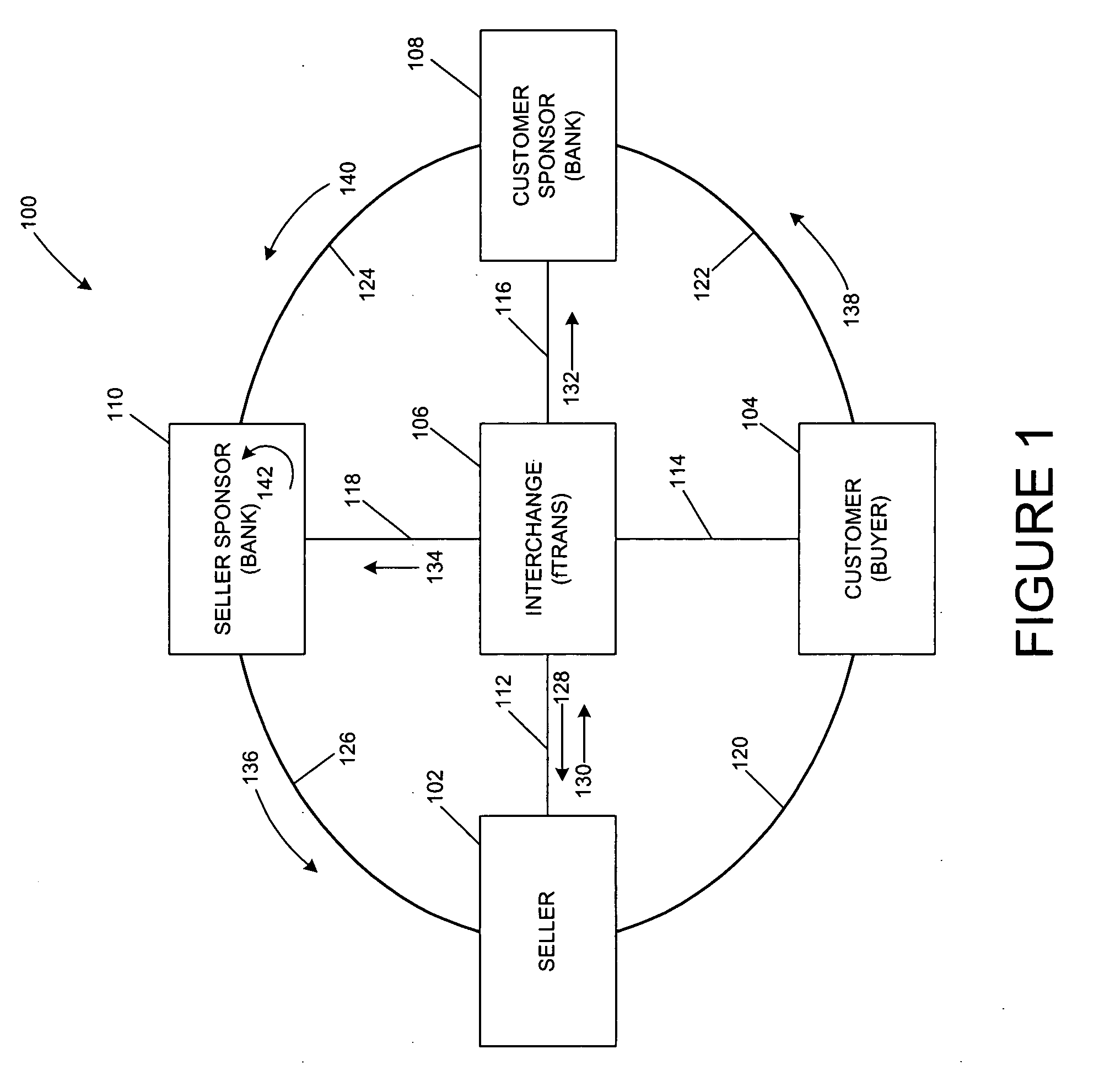

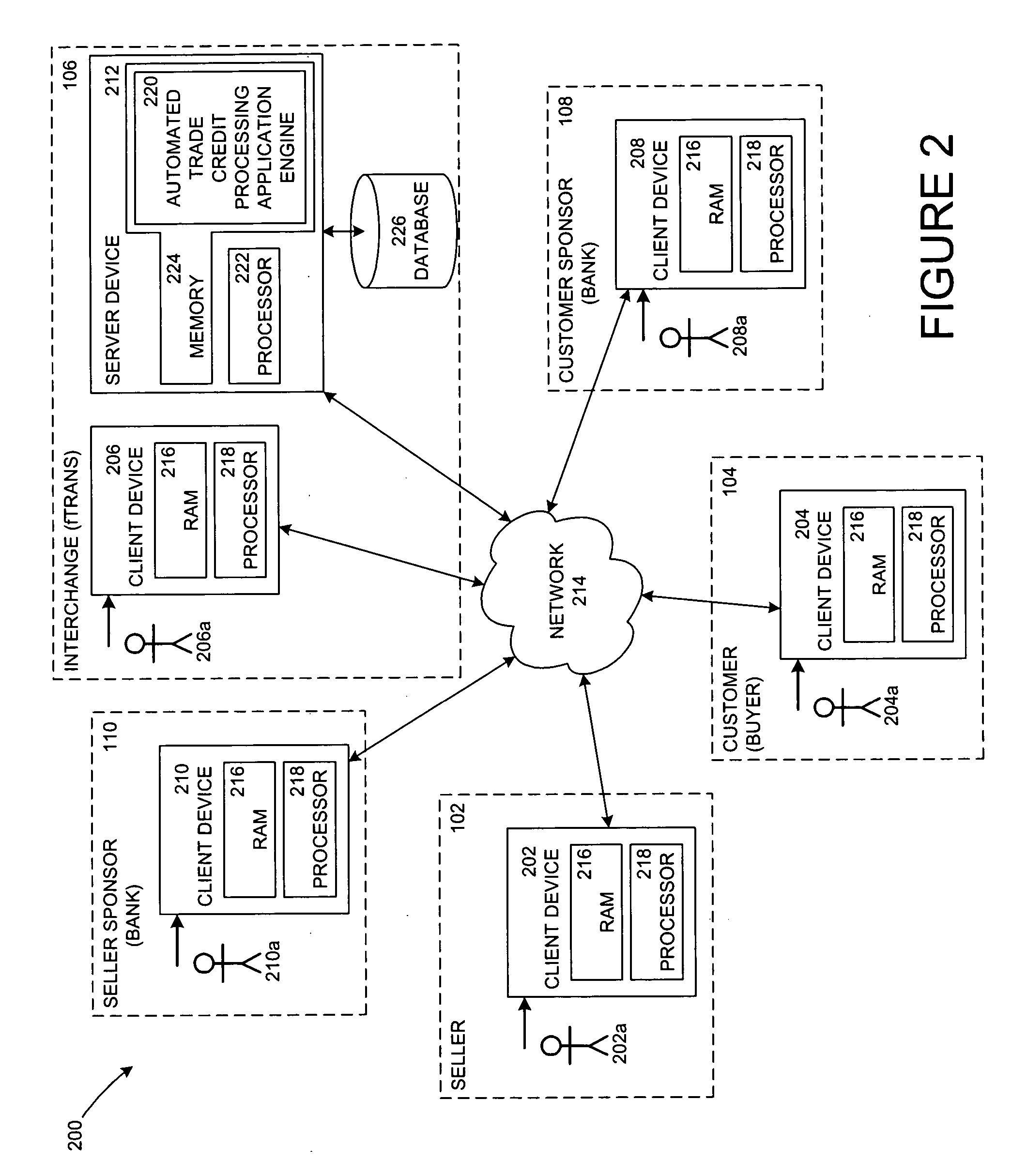

Systems and methods for automated processing, handling, and facilitating a trade credit transaction

InactiveUS20060173772A1Automates processing and handling and facilitatingHighly secure and liquid collateralFinancePaymentInvoice

The present invention relates to methods and systems for automated processing, handling, and facilitating a trade credit transaction. One embodiment of the invention can comprise an automated trade credit processing application engine. The automated trade credit processing application engine can be adapted to approve a customer for a purchase using trade credit, and cause an invoice associated with the purchase to be assigned to a customer sponsor. The automated trade credit processing application engine can be further adapted to determine an advance for a seller sponsor to pay to a seller associated with the purchase, wherein the customer sponsor can guarantee payment of some or all of the invoice to the seller sponsor. Moreover, the automated trade credit processing application engine can be adapted to determine an allocation for the payment, wherein the allocation can be applied by the seller sponsor to an account associated with the seller, after a customer sponsor makes a payment against the invoice to the seller sponsor.

Owner:FTRANS

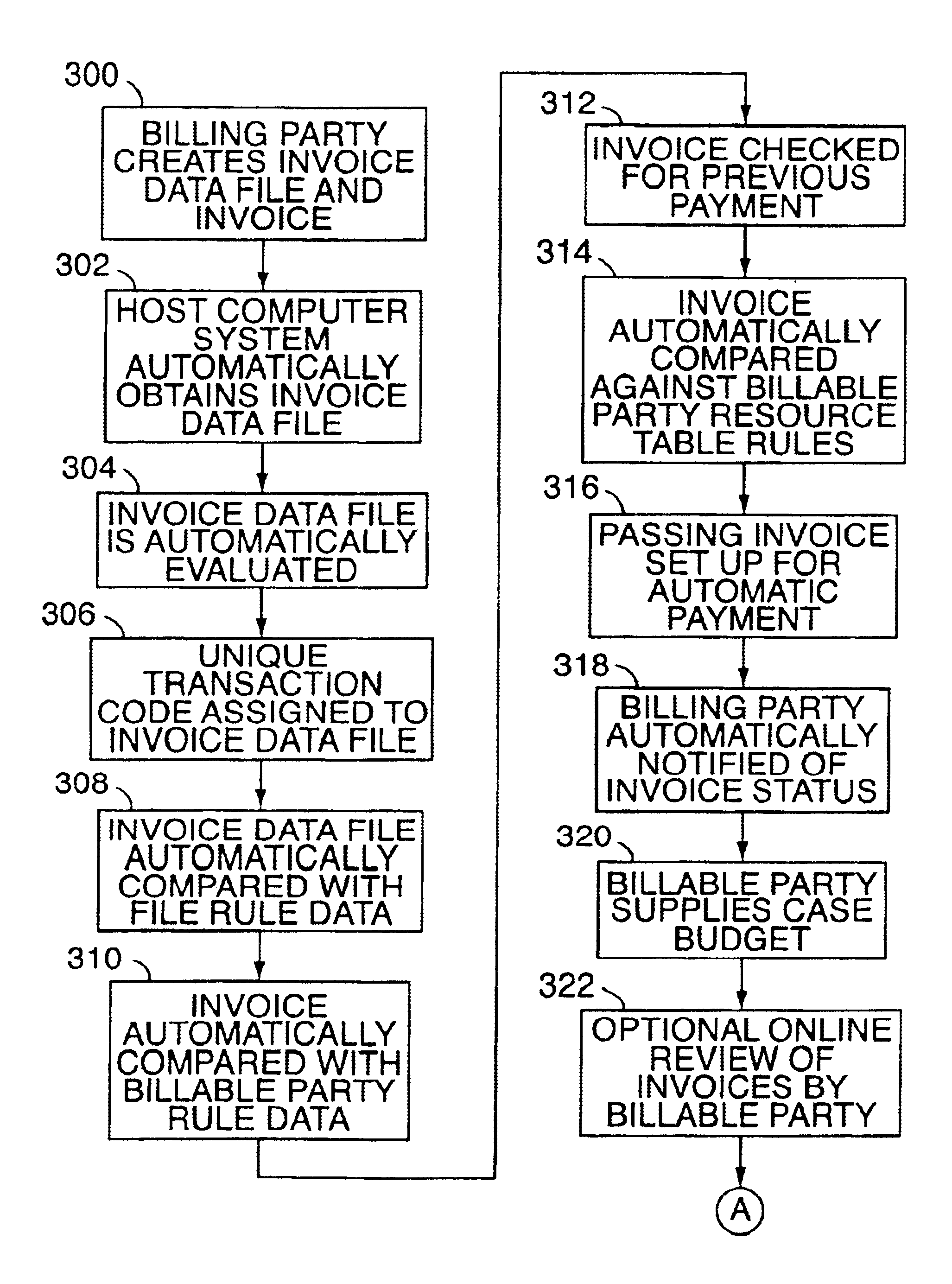

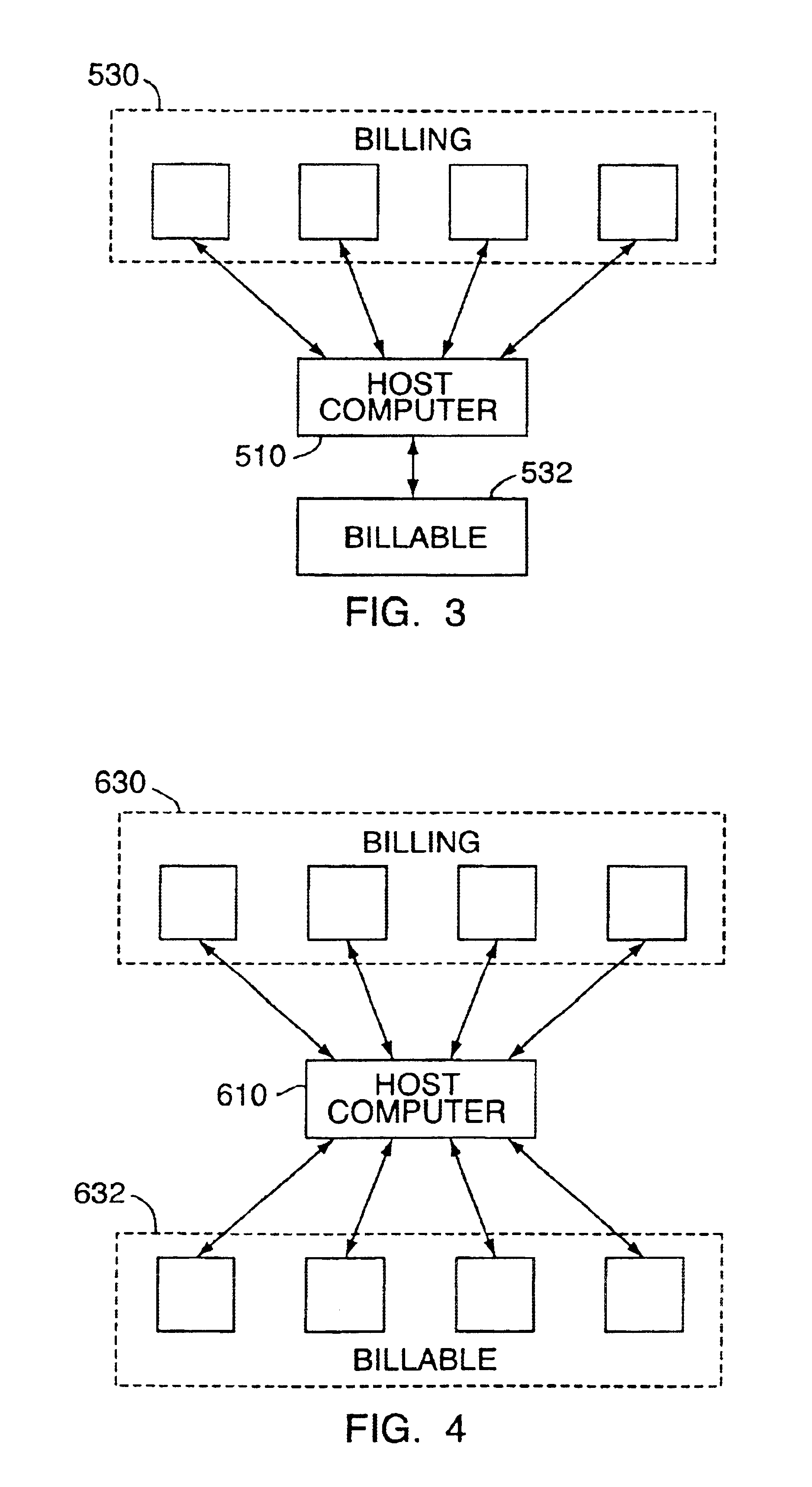

Method for automatic processing of invoices

A computerized method of automatically generating payment for electronic billing data including automatically obtaining billing data in an electronic format from a billing party for a billable party, and automatically comparing the billing data with rule data defined by the billable party. The method includes automatically authorizing generation of payment data for the billing party if the billing data satisfies the comparison with the rule data.

Owner:TYMETRIX

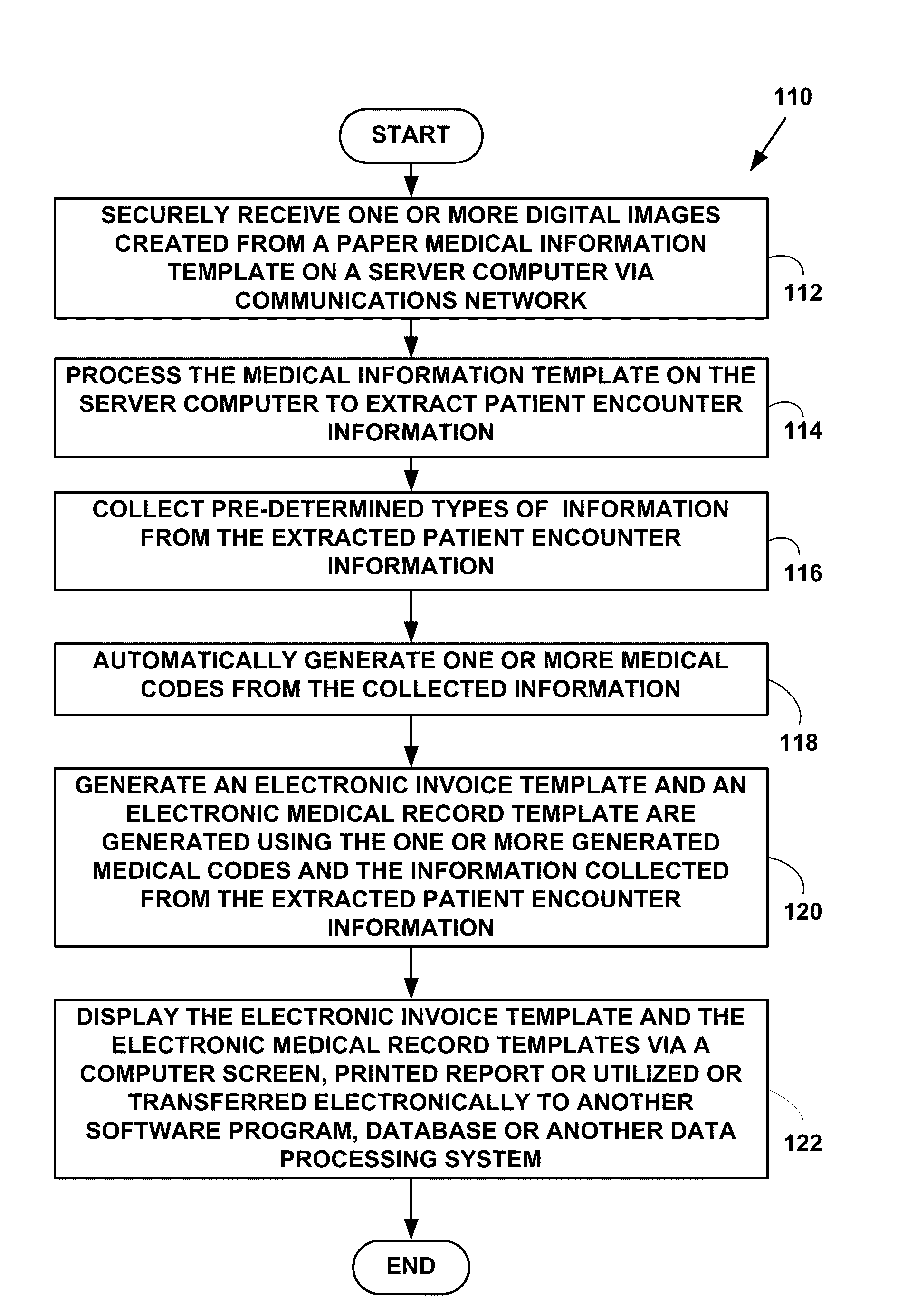

Method and system for automated medical records processing

ActiveUS20100094657A1Reduce complexityReduce riskDigital data processing detailsPatient personal data managementMedical recordMedicine

A method and system for automated medical records processing. The method and system includes plural electronic medical templates specifically designed such that they reduce the complexity and risk associated with collecting patient encounter information, creating a medical diagnosis and help generate the appropriate number and type medical codes for a specific type of medical practice when processed. The medical codes and other types of processed patient encounter information are displayed in real-time on electronic medical records and invoices immediately after a patient encounter.

Owner:PRACTICE VELOCITY

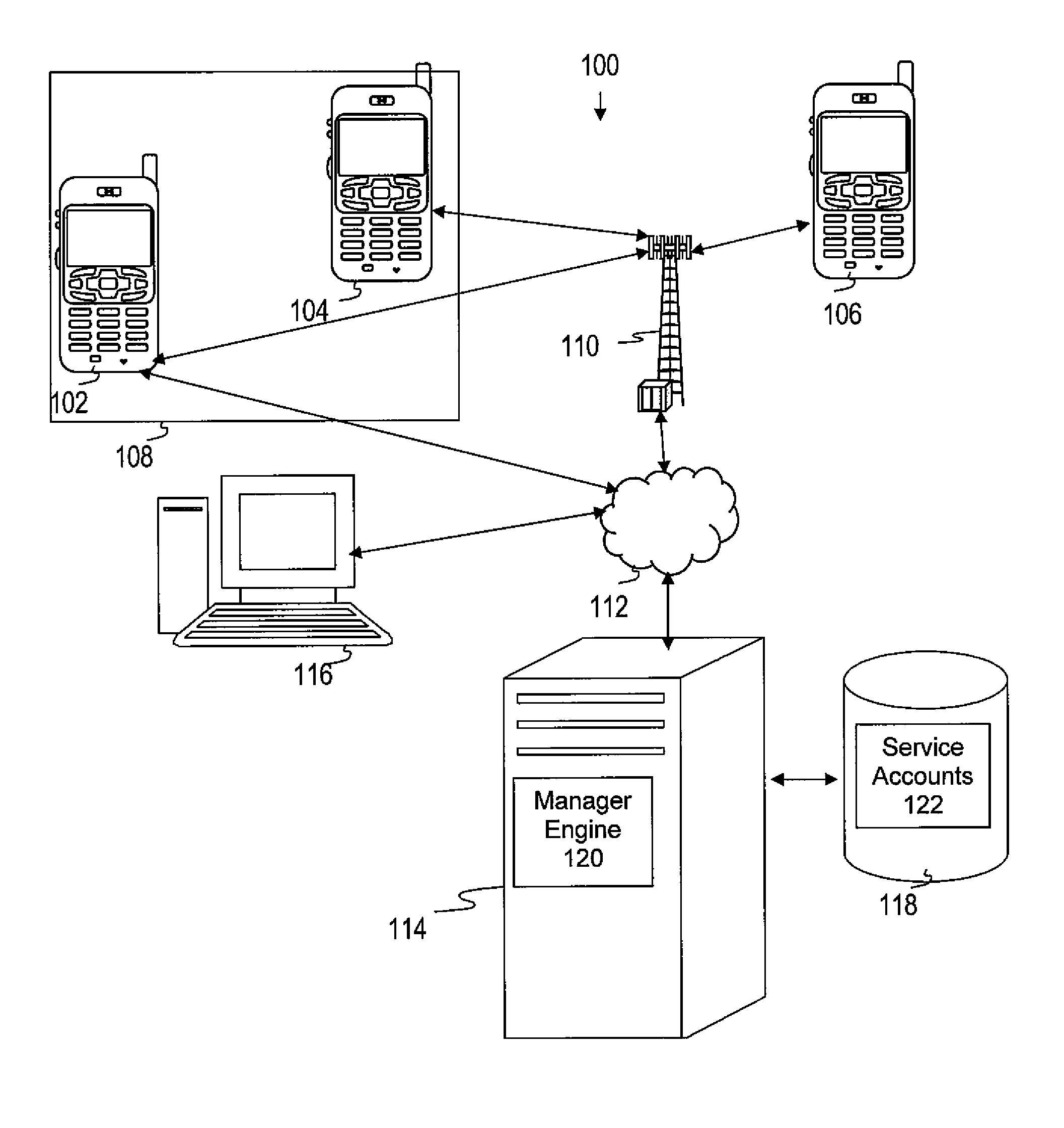

Pre and post-paid service plan manager

A service plan manager is provided, including a manager engine and a storage device to store data for a service account that comprises a pre-paid service plan associated with a first communication device and a post-paid service plan associated with a second communication device. The manager engine determines whether a balance associated with the pre-paid service plan is below a threshold, and communicates a request for increasing the balance to a device associated with the service account if the balance associated with the pre-paid service plan is below the threshold. The manager engine discontinues service for the first communication device until an approval of the request for increasing the balance is received, increases the balance in response to a receipt of the approval of the request for increasing the balance, and adds an amount associated with increasing the balance to an invoice associated with the service account.

Owner:T MOBILE INNOVATIONS LLC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com