Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

11288results about "Complete banking machines" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Method and apparatus for funds and credit line transfers

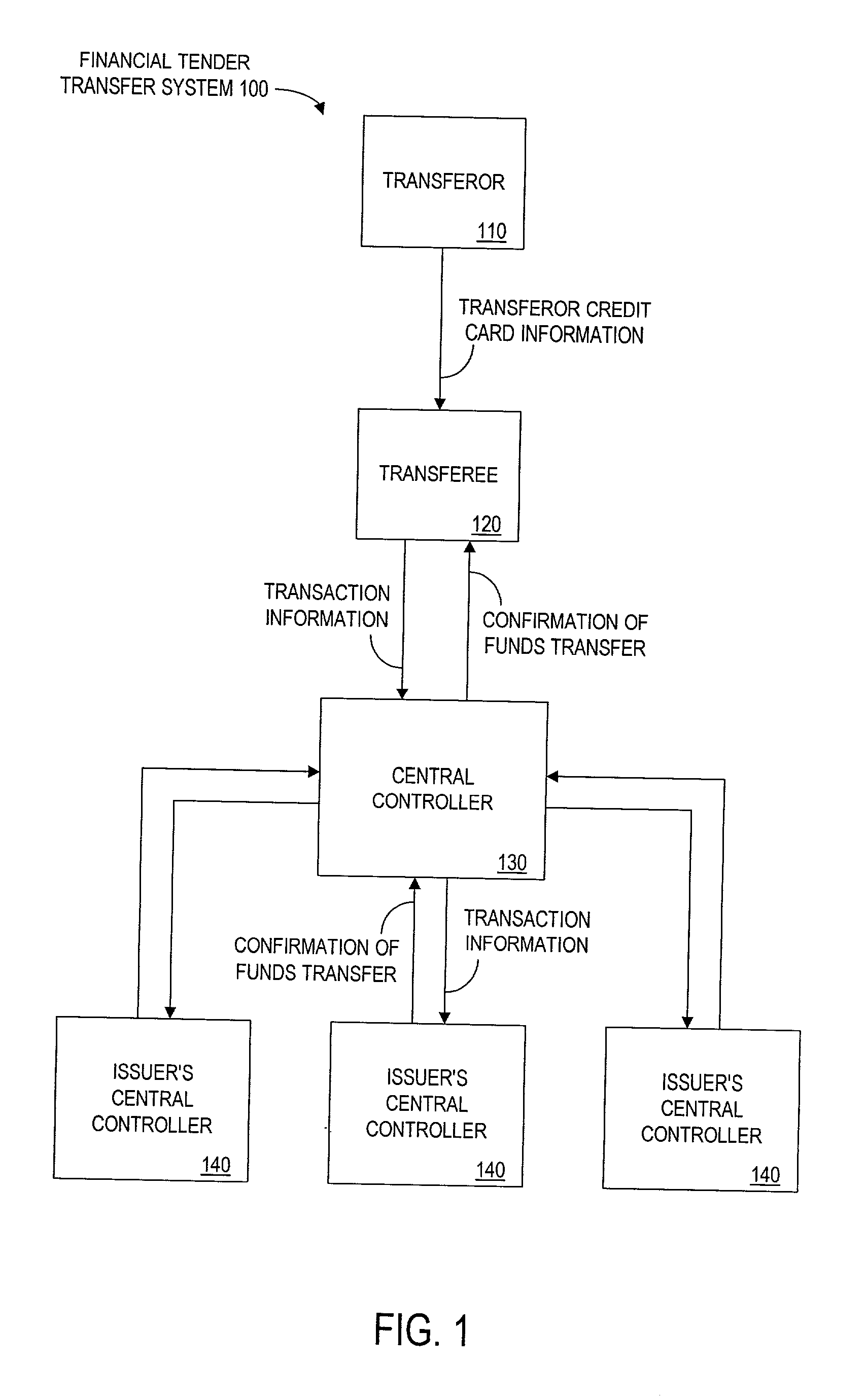

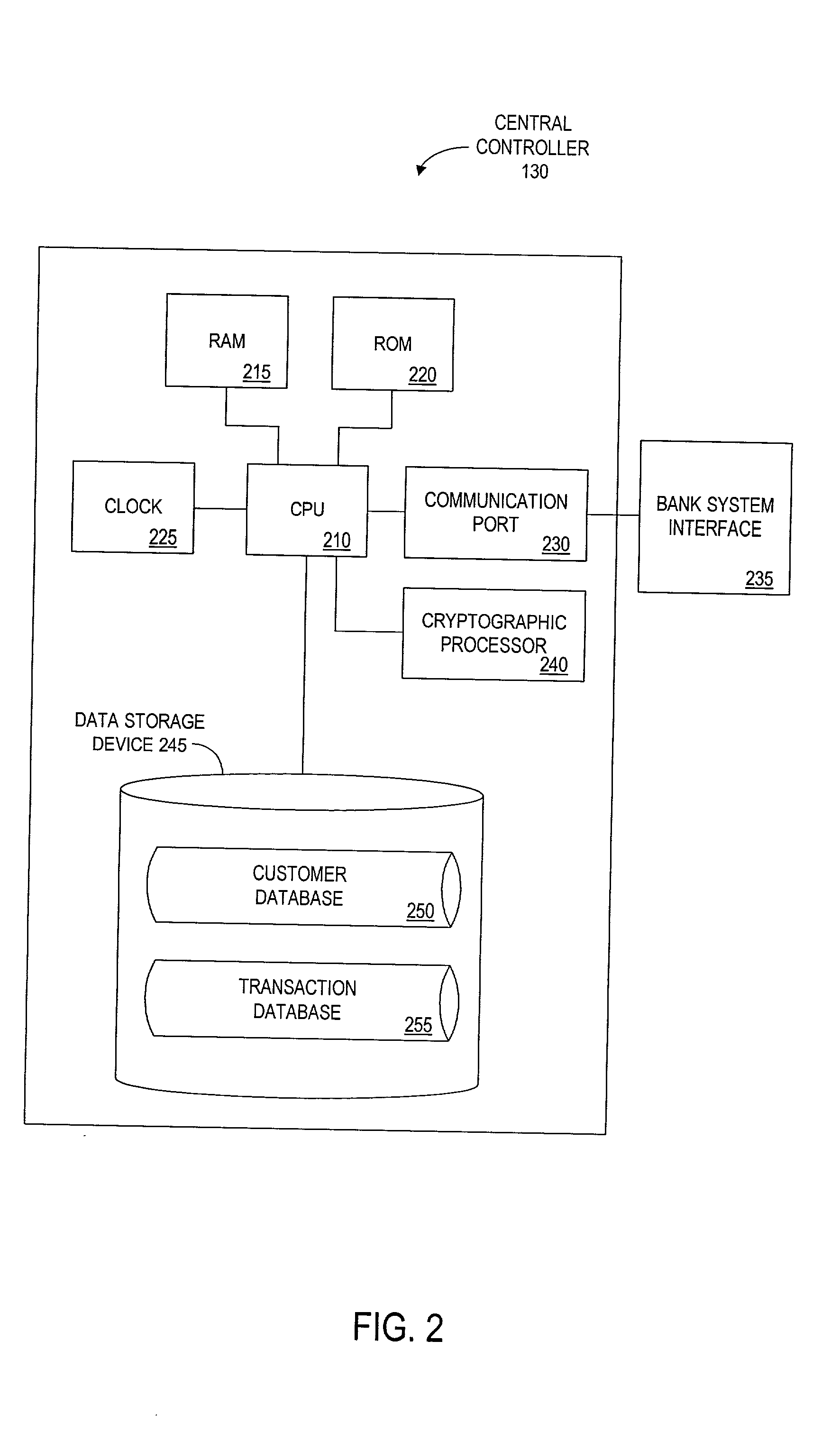

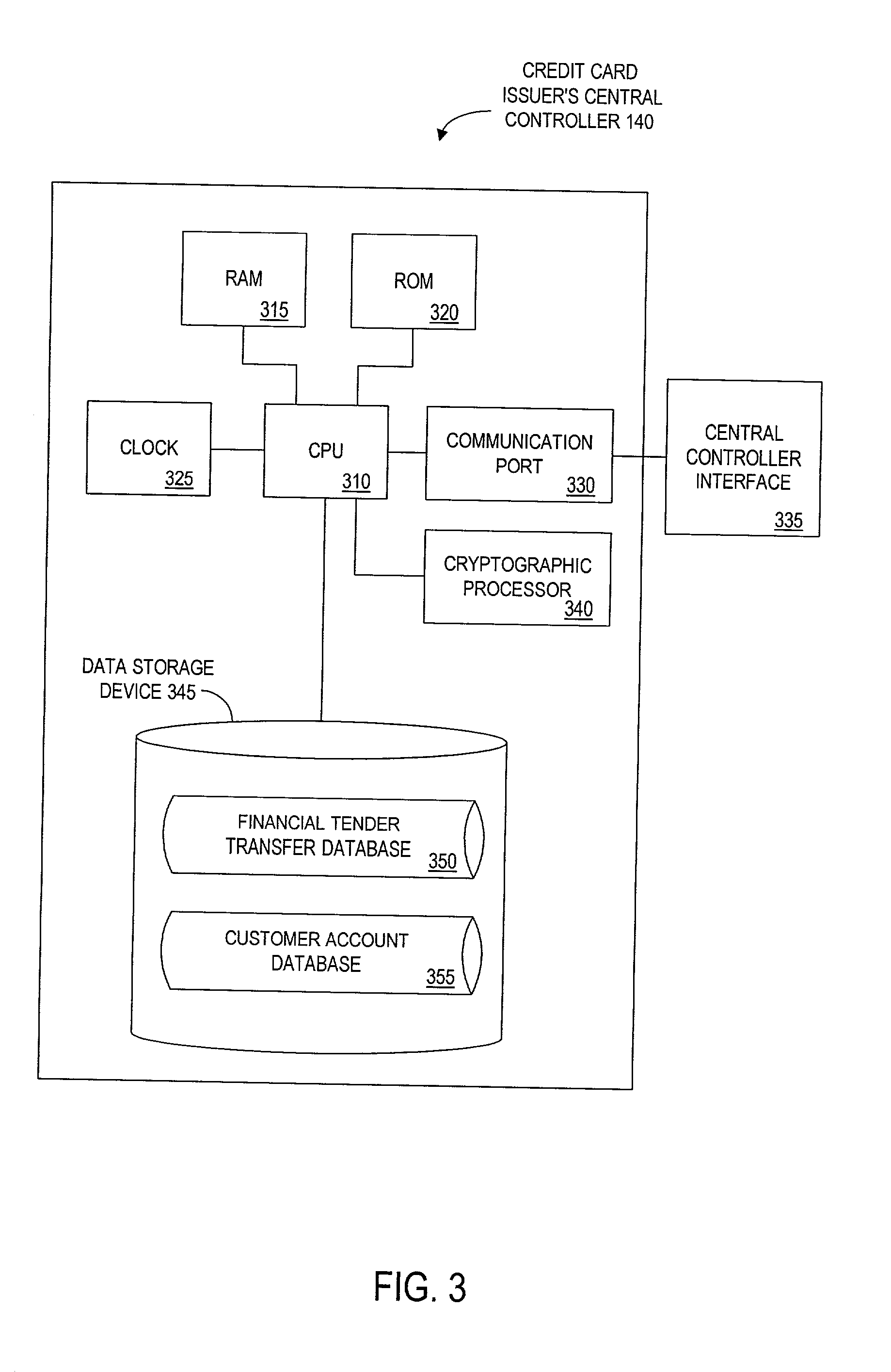

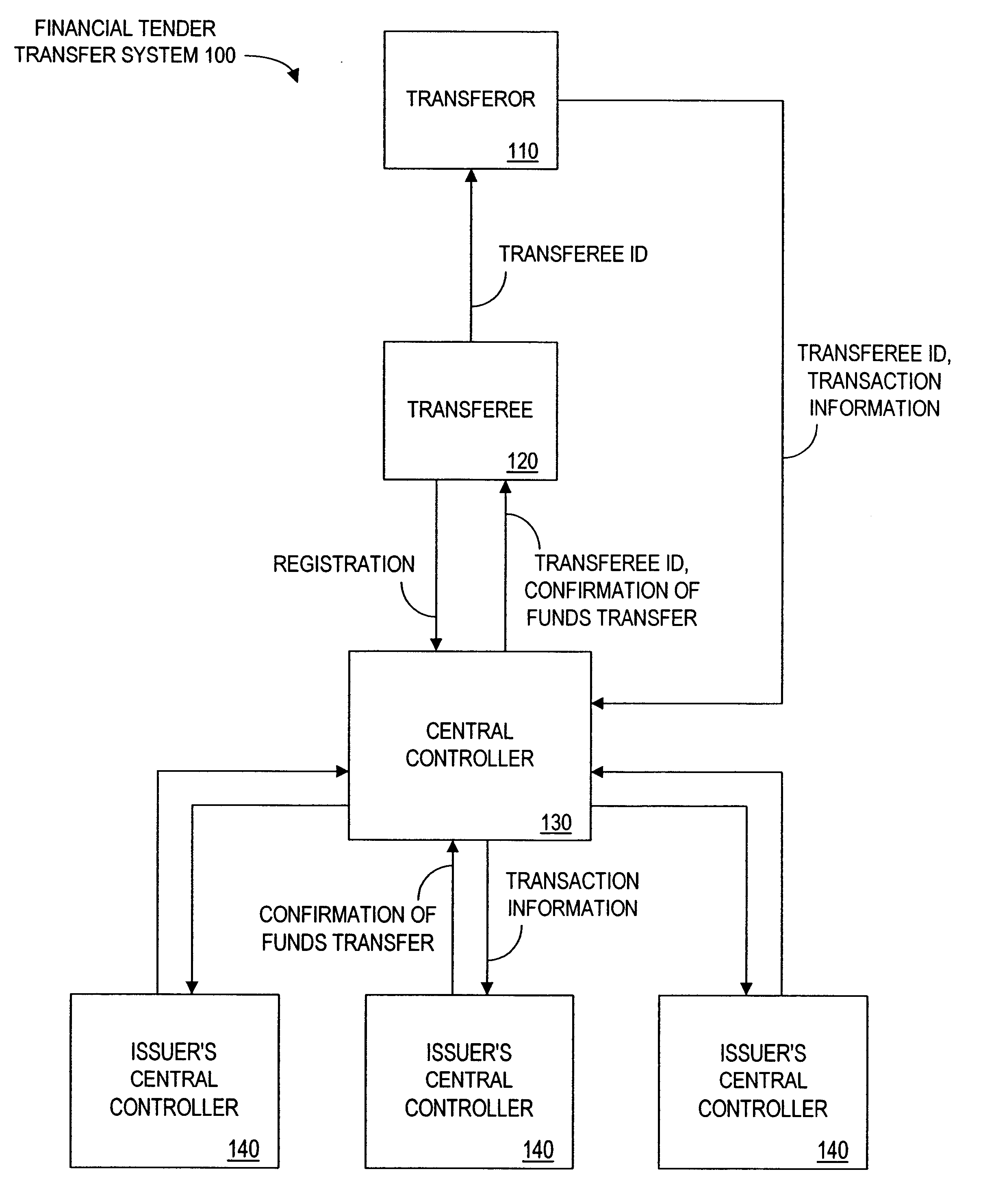

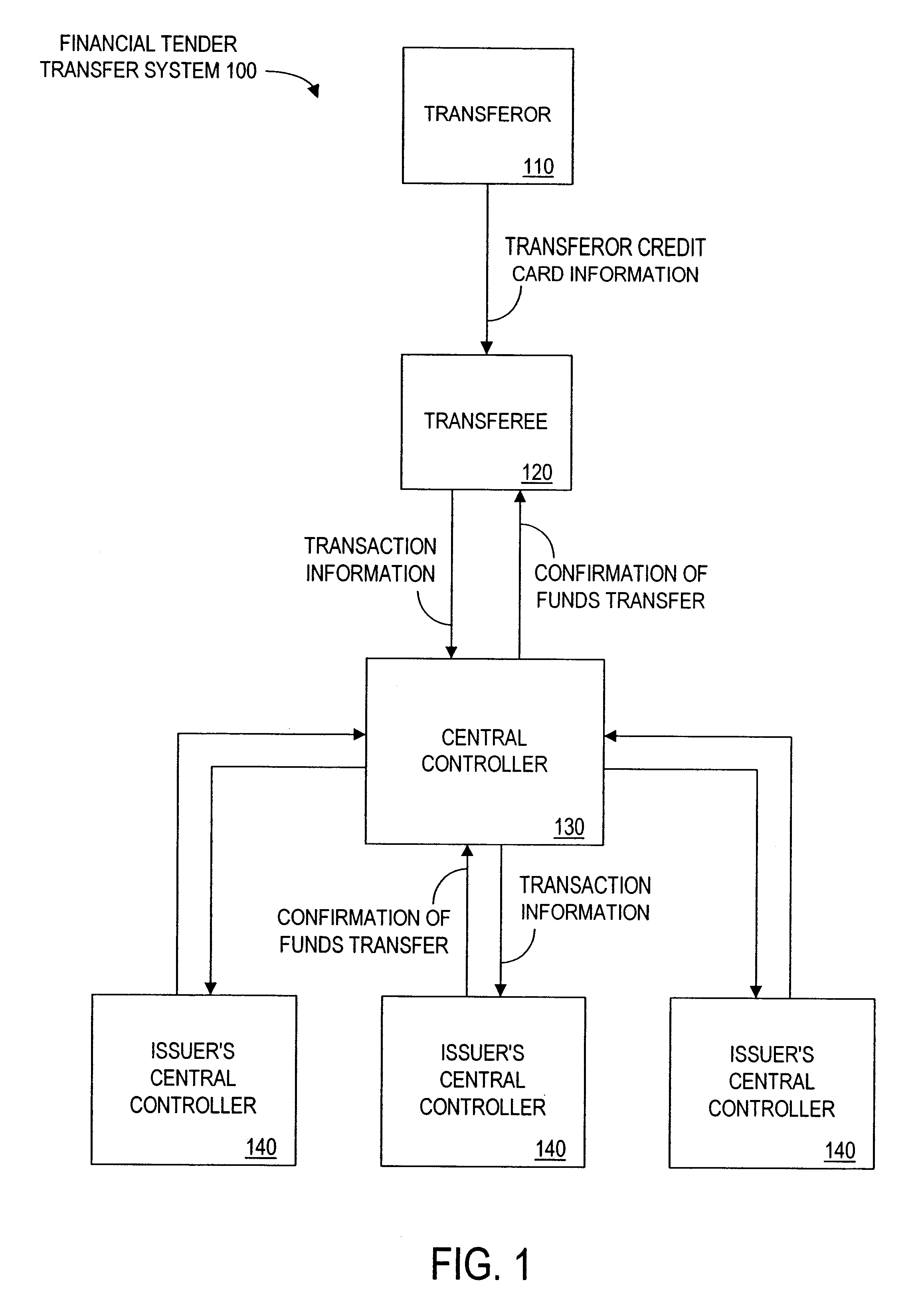

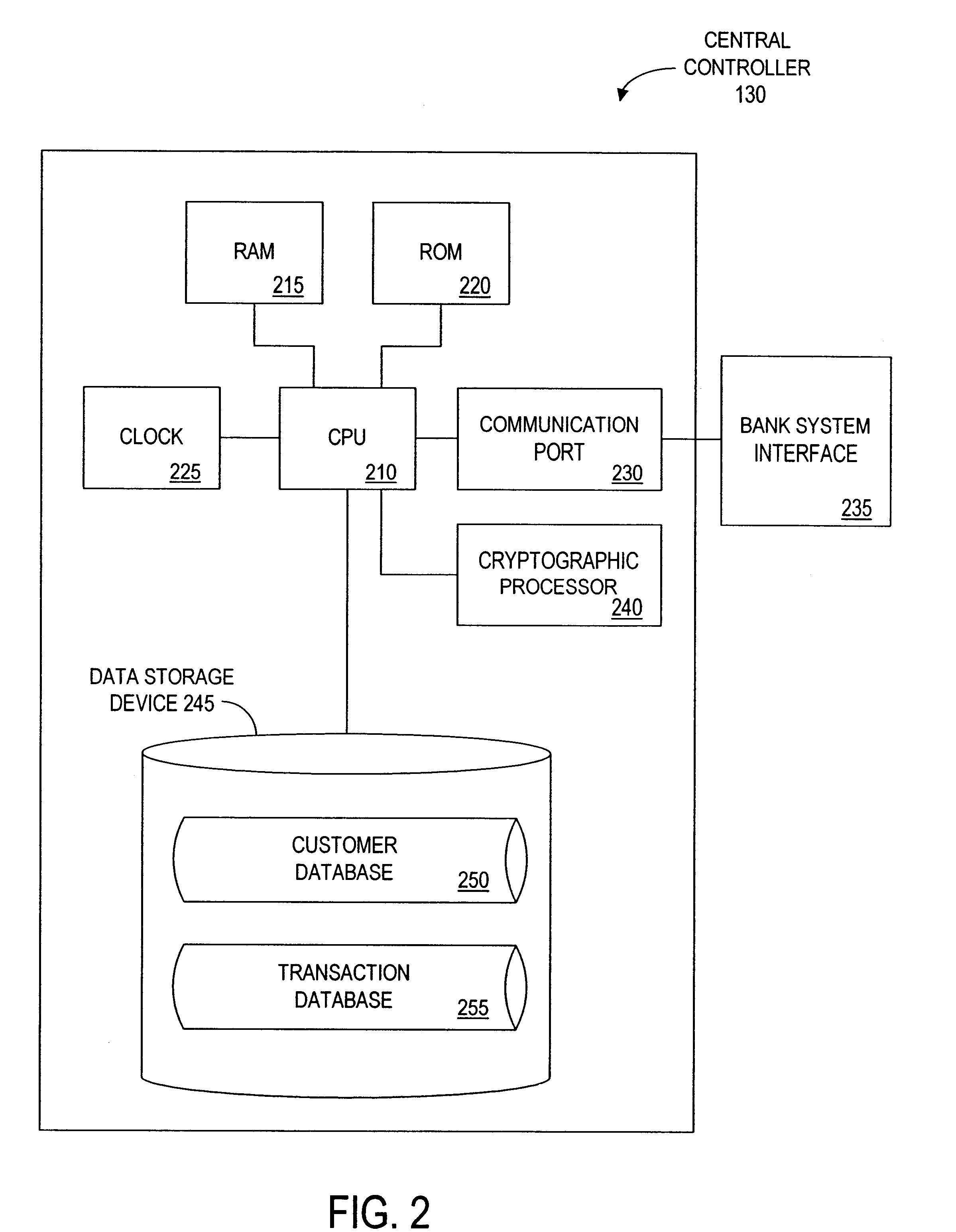

A financial tender transfer system allows a transferor to transfer credit or make payment to a transferee by debiting the credit card of the transferor and crediting the credit card of the transferee. The financial tender transfer system gives the transferee immediate access to the transferred money and ensures the transferor's credit card is valid. Neither party needs to give their credit card number to the other, so security is preserved. Any amount of value up to the full credit line of the transferor can be transferred to the transferee.

Owner:PAYPAL INC

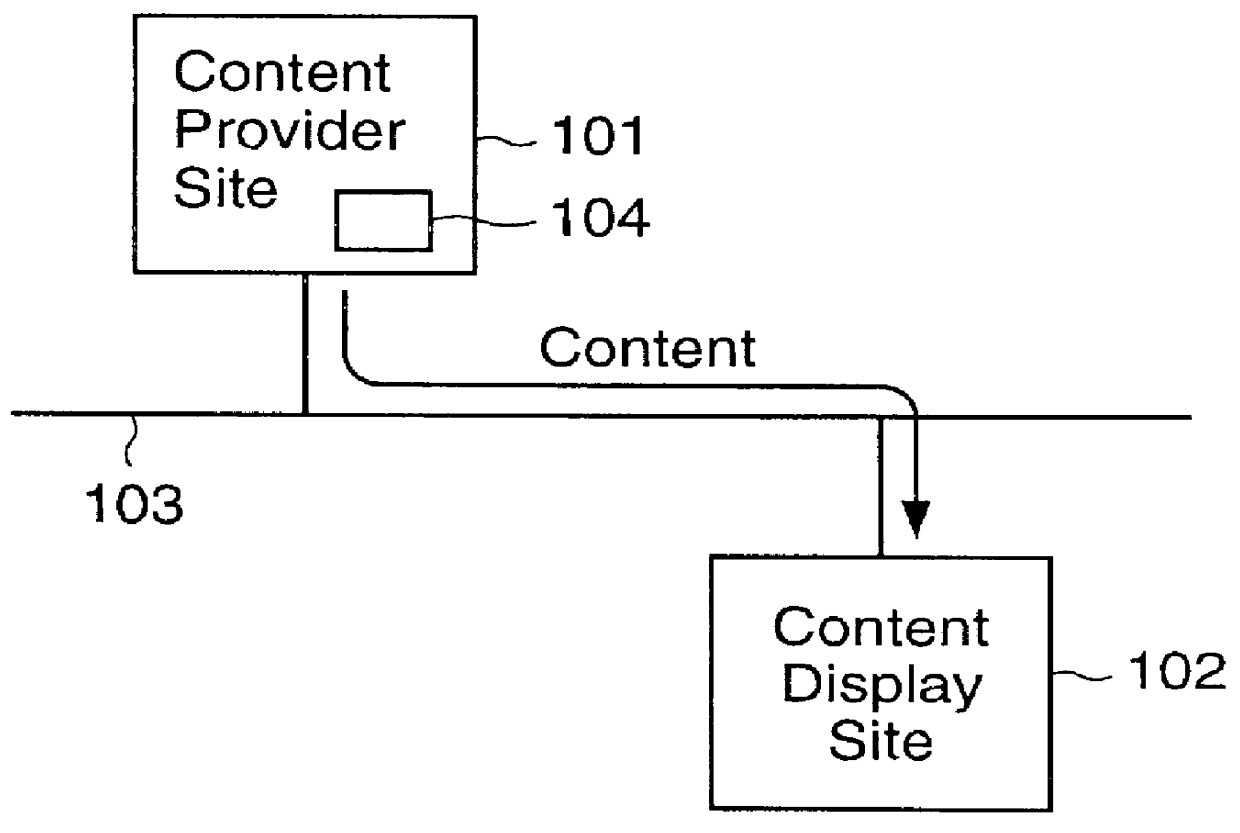

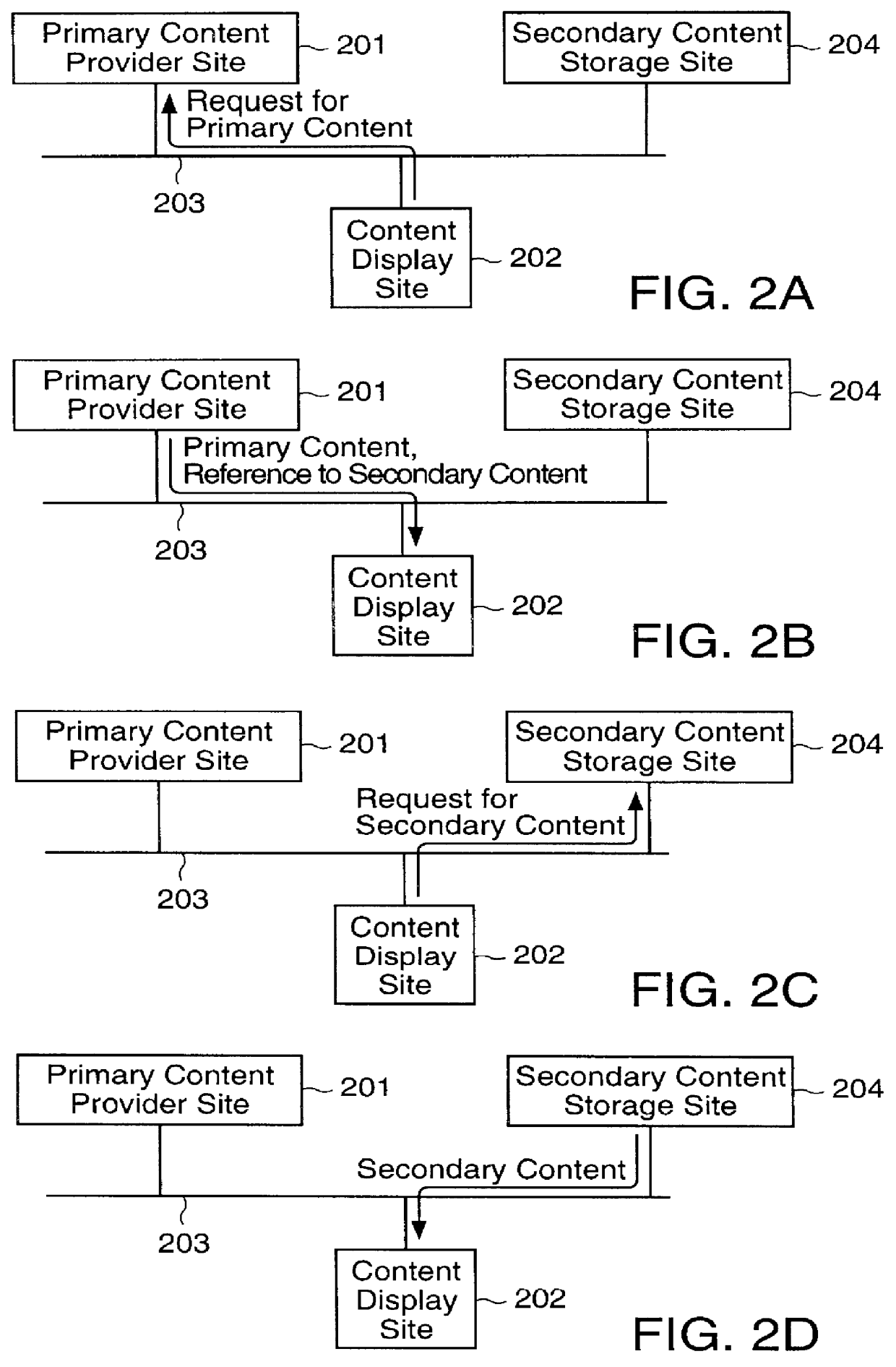

Content display monitor

InactiveUS6108637AComplete banking machinesDigital data information retrievalWeb siteComputerized system

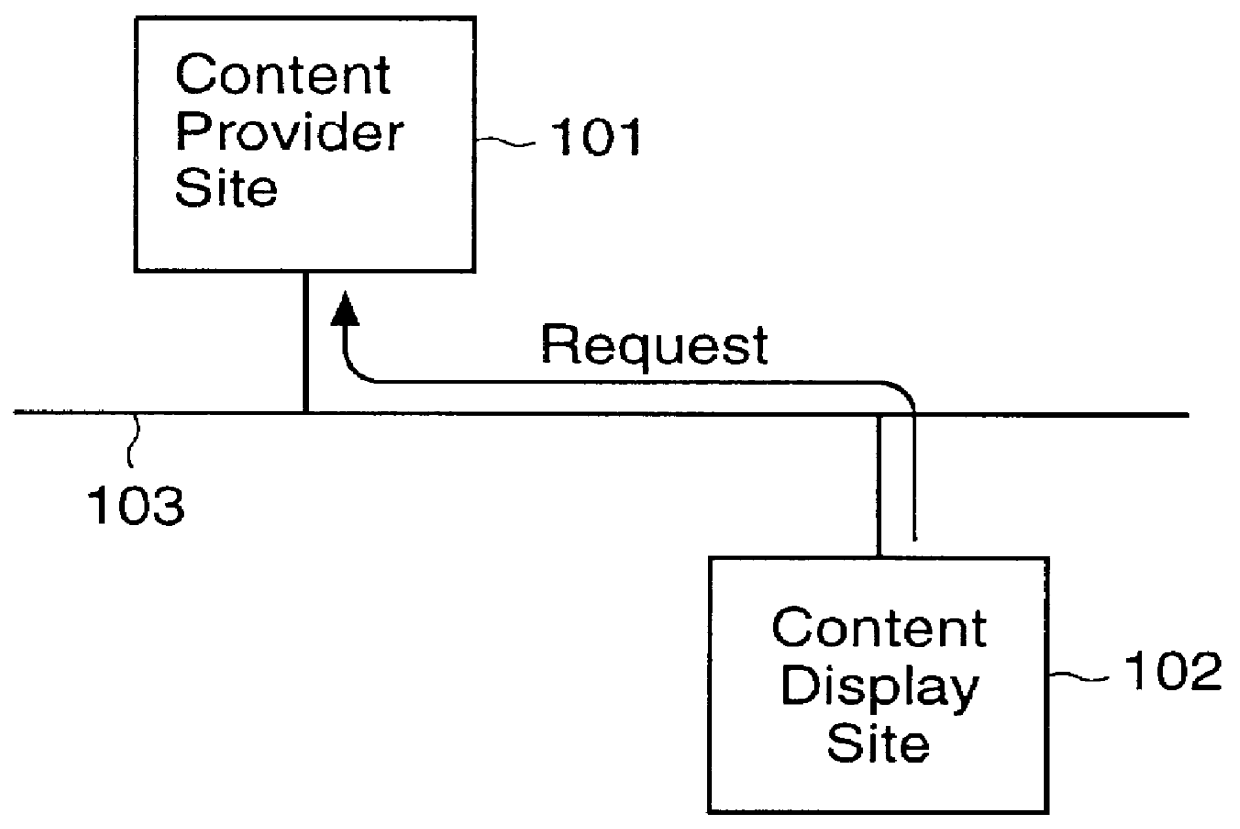

The invention can enable monitoring of the display of content by a computer system. Moreover, the invention can enable monitoring of the displayed content to produce monitoring information from which conclusions may be deduced regarding the observation of the displayed content by an observer. The invention can also enable monitoring of the display at a content display site of content that is provided by a content provider site over a network to the content display site. Additionally, the invention can enable the expeditious provision of updated and / or tailored content over a network from a content provider site to a content display site so that the content provider's current and appropriately tailored content is always displayed at the content display site. Aspects of the invention related to transfer of content over a network are generally applicable to any type of network. However, it is contemplated that the invention can be particularly useful with a computer network, including private computer networks (e.g., America Online TM ) and public computer networks (e.g., the Internet). In particular, the invention can be advantageously used with computer networks or portions of computer networks over which video and / or audio content are transferred from one network site to another network site for observation, such as the World Wide Web portion of the Internet.

Owner:NIELSEN COMPANY US LLC THE A DELAWARE LIMITED LIABILITY

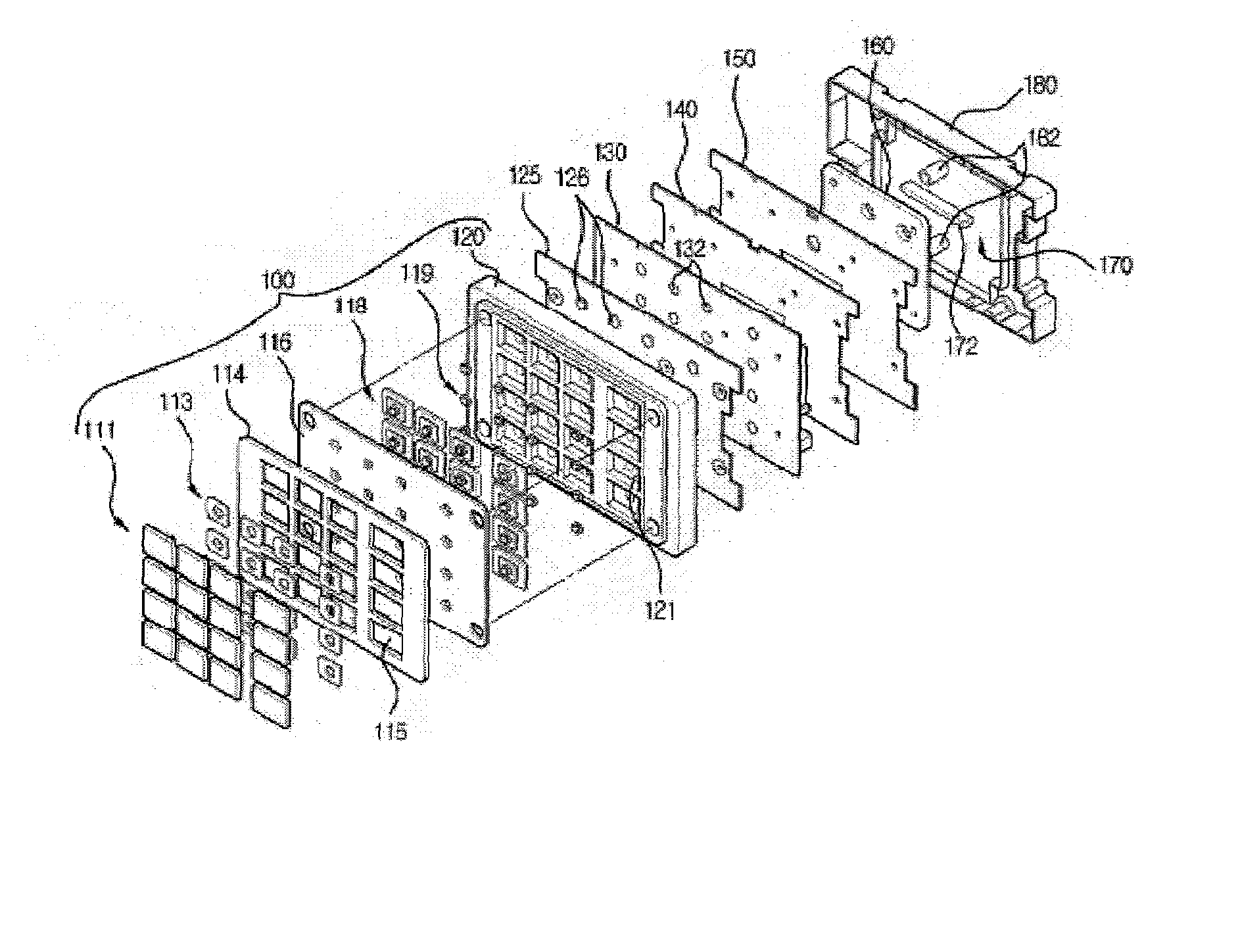

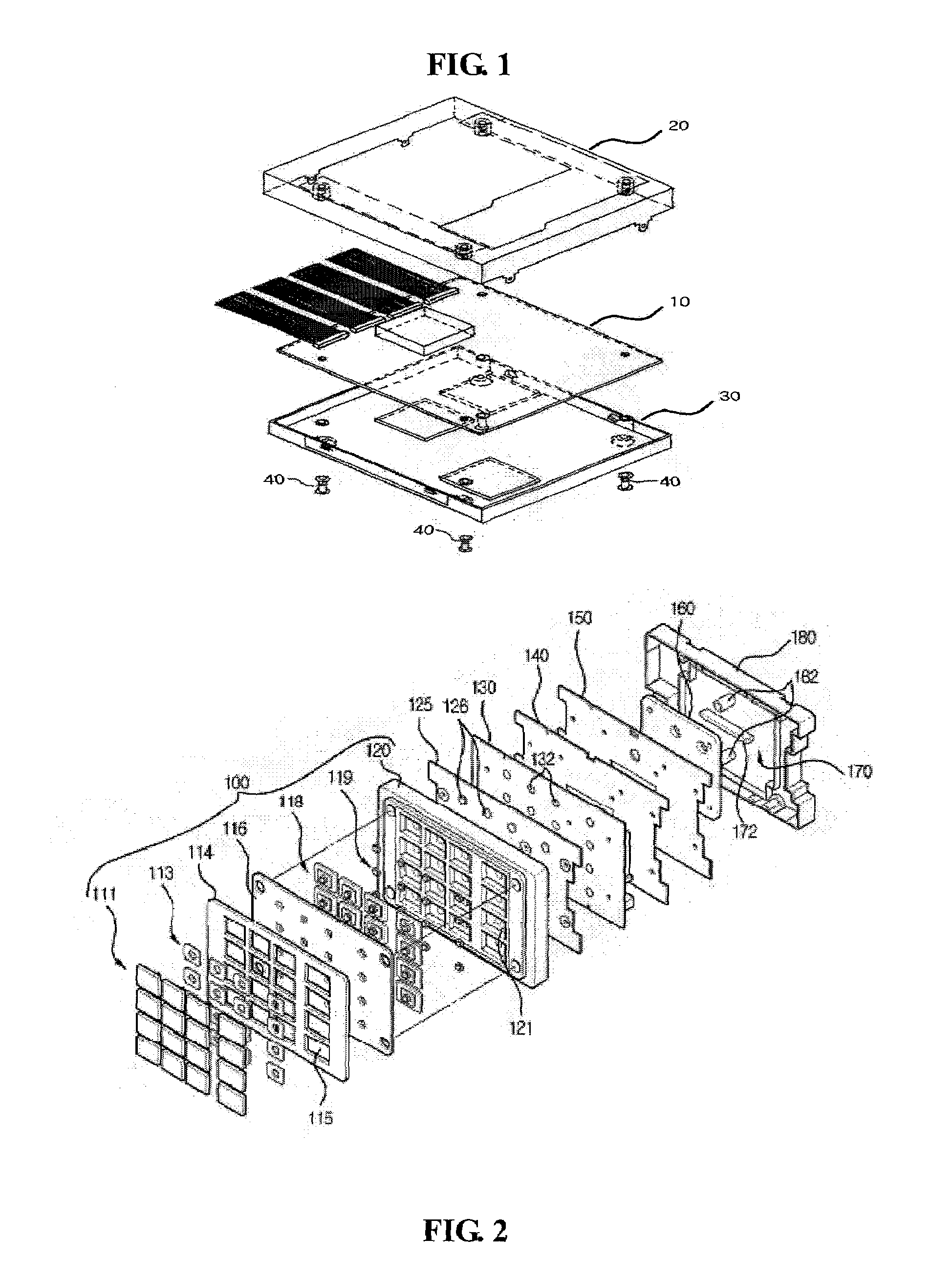

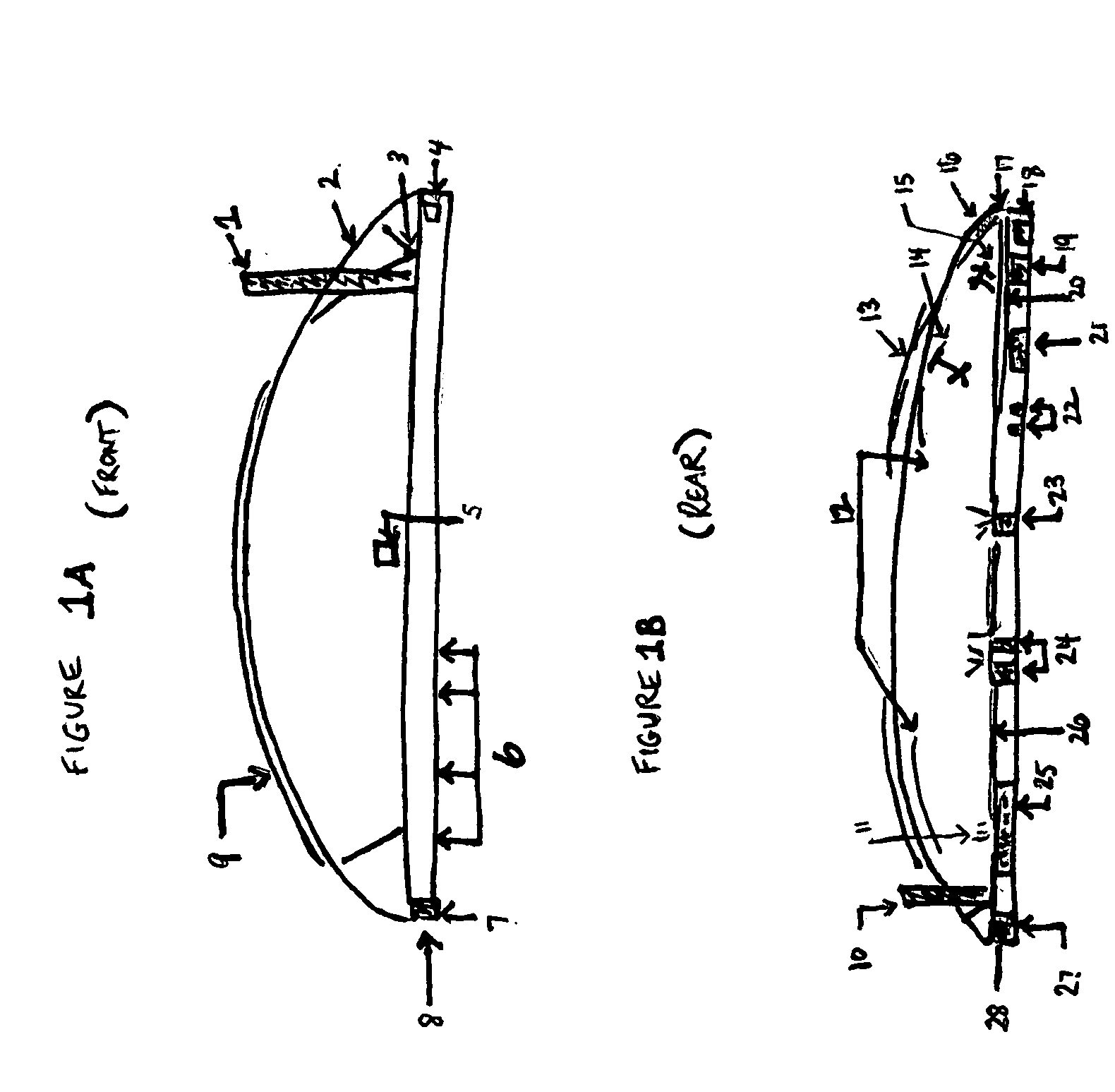

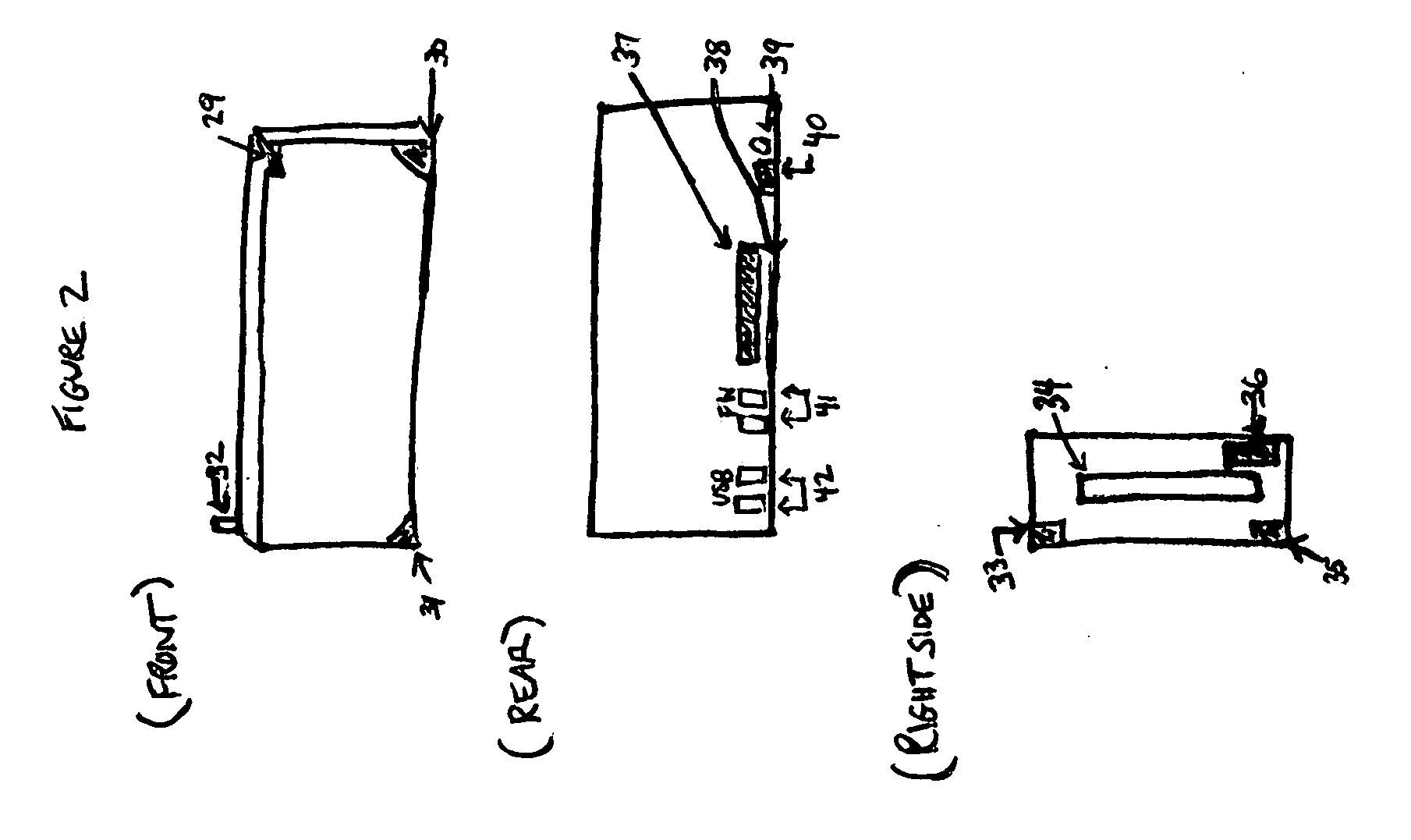

Tamper resistant pin entry apparatus

ActiveUS7238901B2Prevent leakagePrevent penetrationComplete banking machinesEmergency casingsPasswordElectric power system

Disclosed is a tamper resistant PIN entry apparatus for input of a key and for encryption of a password in a cash transaction machine. The PIN entry apparatus supplies the electric power to a memory of an electric circuit section, in such a manner that a first rod and a second rod of a rear case connect contacts of a key scan board, wherein the first rod is protruded on the rear of a key module including a button provided substantially on the front of the key module and the second rod of the rear case is coupled with the rear of the key module. At this time, in case that the rear case is removed from the key module or damaged, thereby changing the location of any one of the first and the second rods at the contact, the electric circuit section detects the event and destroys the memory itself physically. Otherwise, the electric circuit section makes information stored in the memory physically or softwarely unreadable, thereby preventing the leakage of the information.

Owner:NAUTILUS HYOSUNG

Method and apparatus for funds and credit line transfers

A financial tender transfer system allows a transferor to transfer credit or make payment to a transferee by debiting the credit card of the transferor and crediting the credit card of the transferee. The financial tender transfer system gives the transferee immediate access to the transferred money and ensures the transferor's credit card is valid. Neither party needs to give their credit card number to the other, so security is preserved. Any amount of value up to the full credit line of the transferor can be transferred to the transferee.

Owner:PAYPAL INC

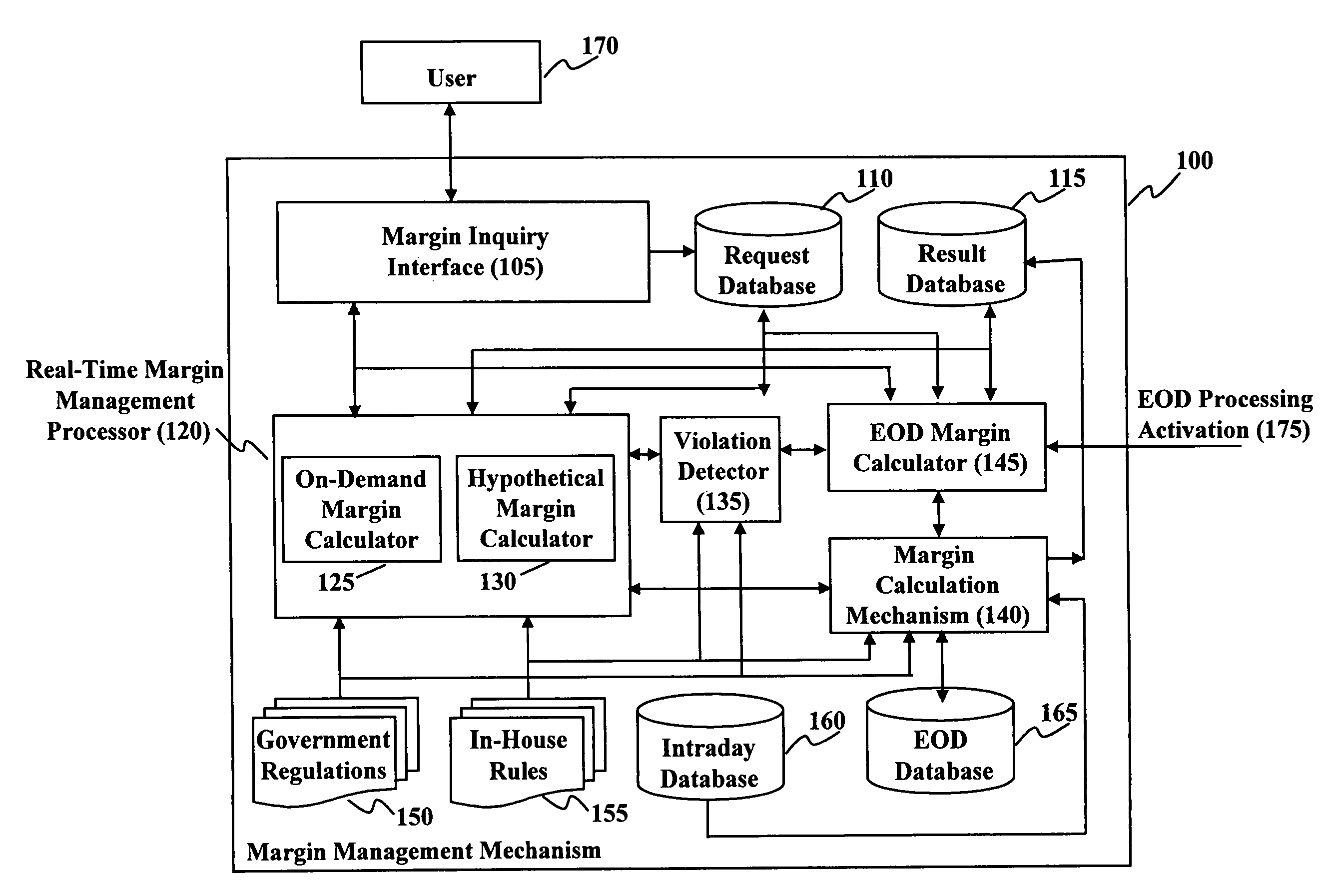

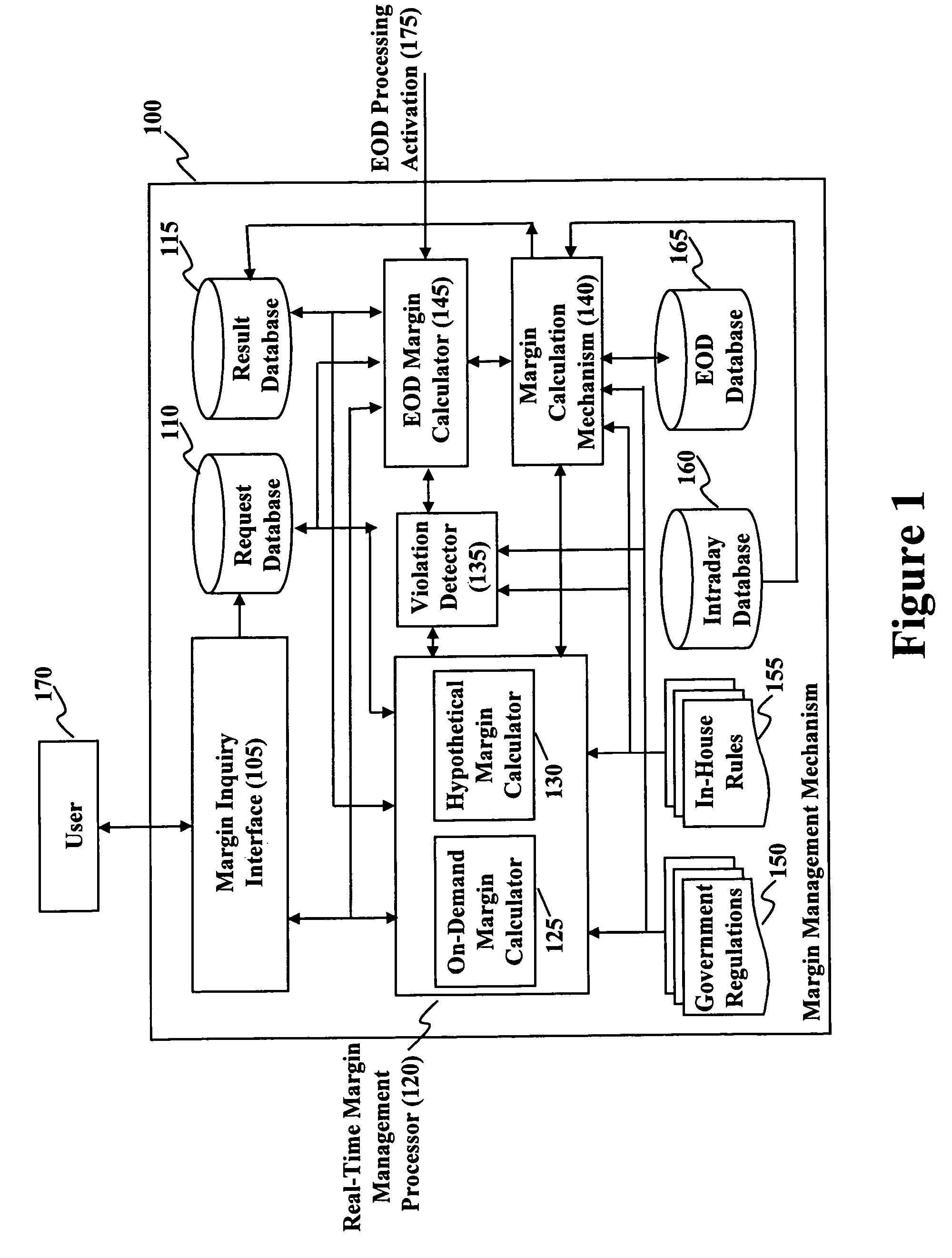

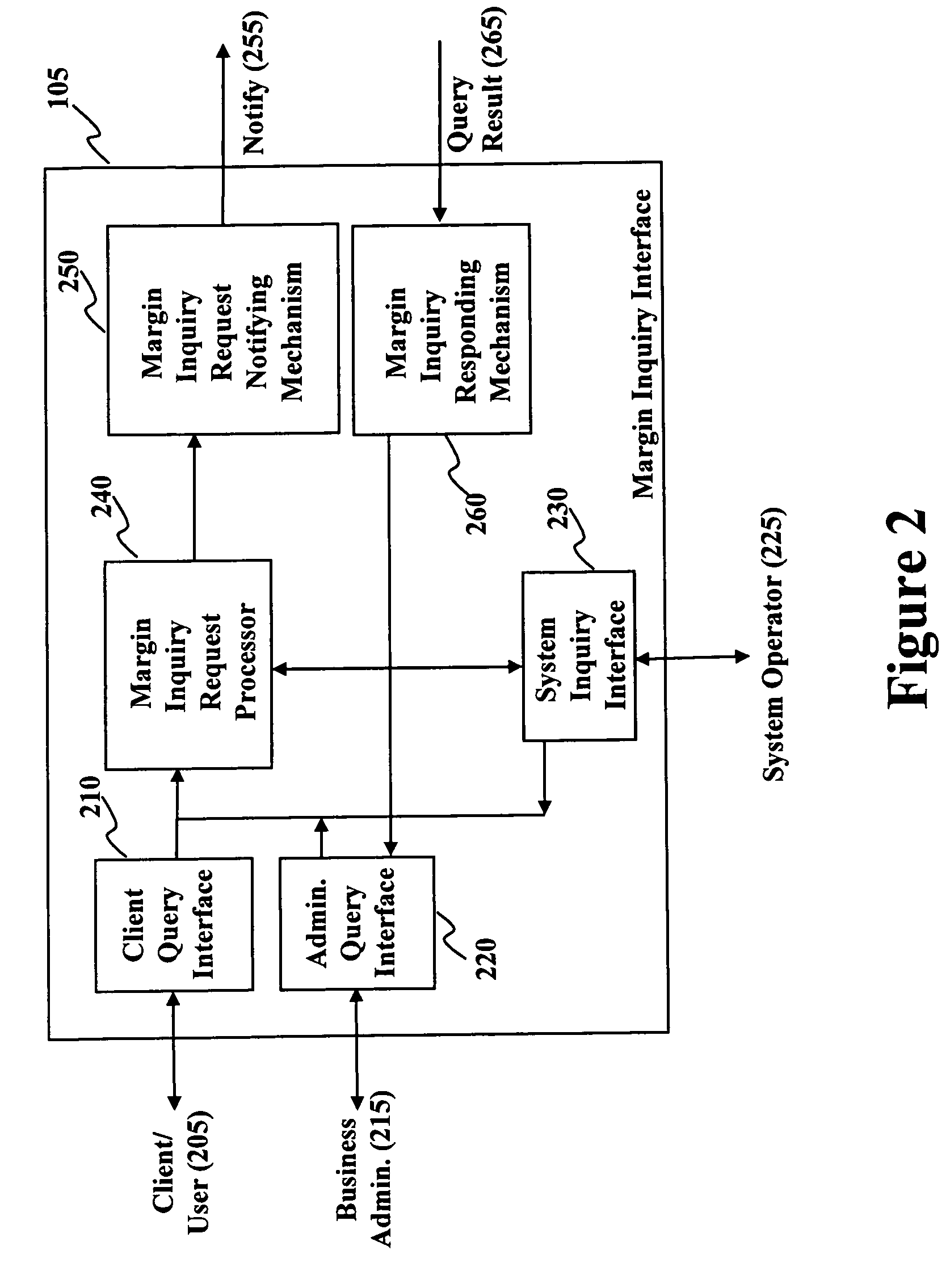

Method and system for real time margin calculation

Owner:UBS BUSINESS SOLUTIONS AG

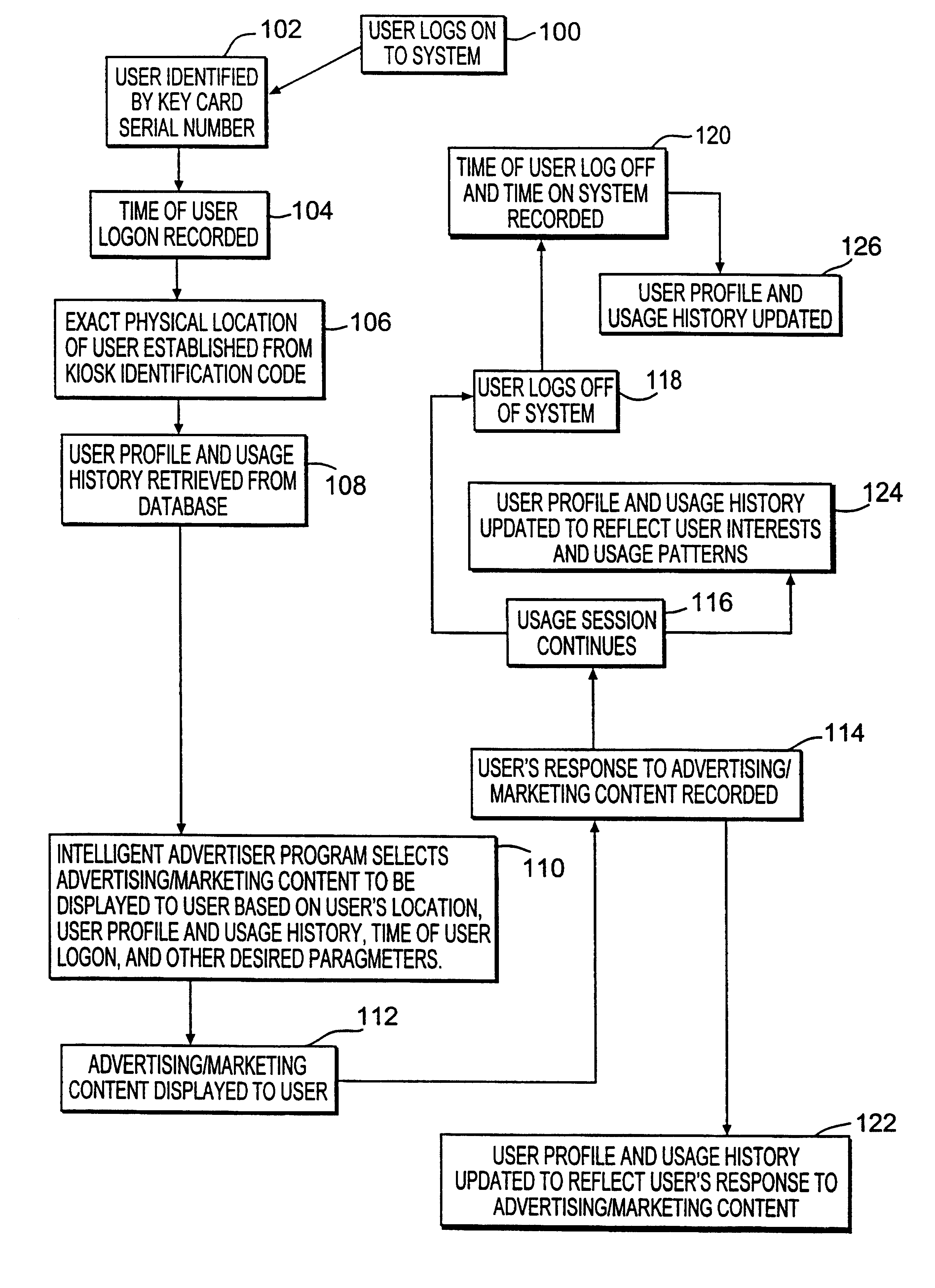

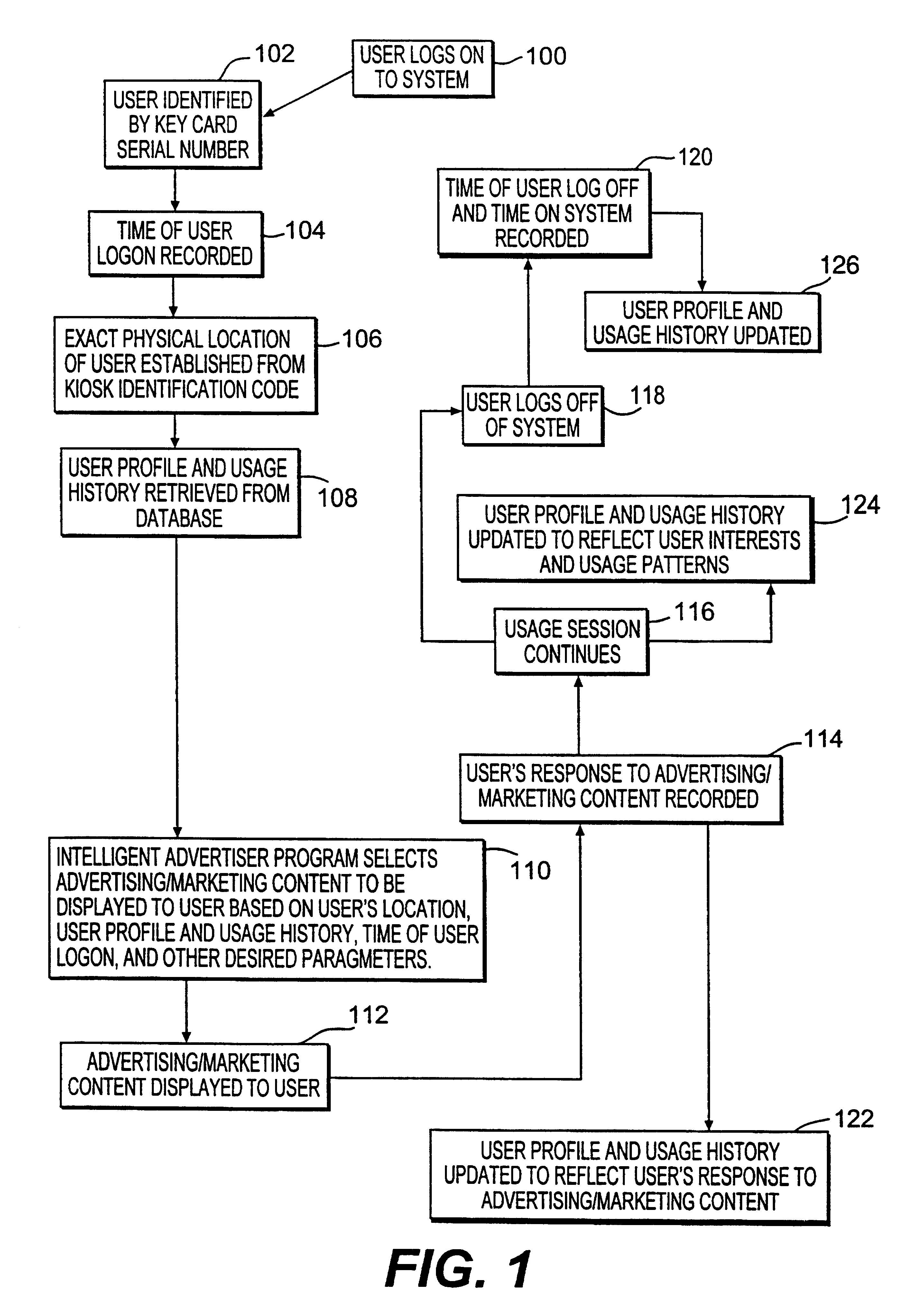

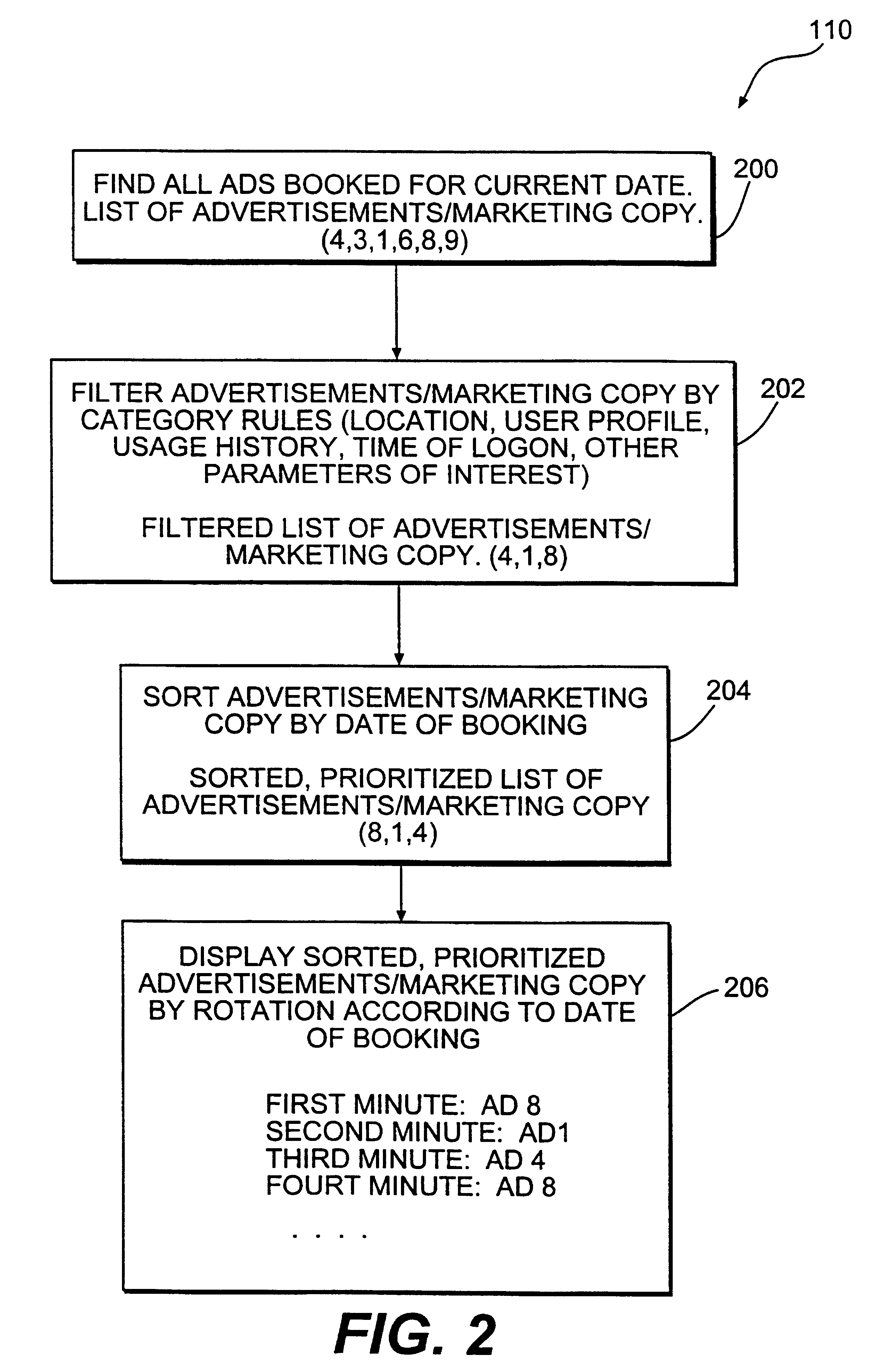

Method and system for providing personalized online services and advertisements in public spaces

InactiveUS6847969B1Without time-consuming searchingComplete banking machinesAcutation objectsPersonalizationPersonal details

A method and system for providing, personalized and integrated online services for communications and commercial transactions both in private and public venues. The invention provides personalized information that is conveniently accessible through a network of public access stations (or terminals) which are enabled by a personal system access card (e.g., smart card). The invention also provides advertisers the opportunity to directly engage action; and potential user-consumers with selected advertising or marketing content based on each user's profile and usage history.

Owner:STREETABPACE

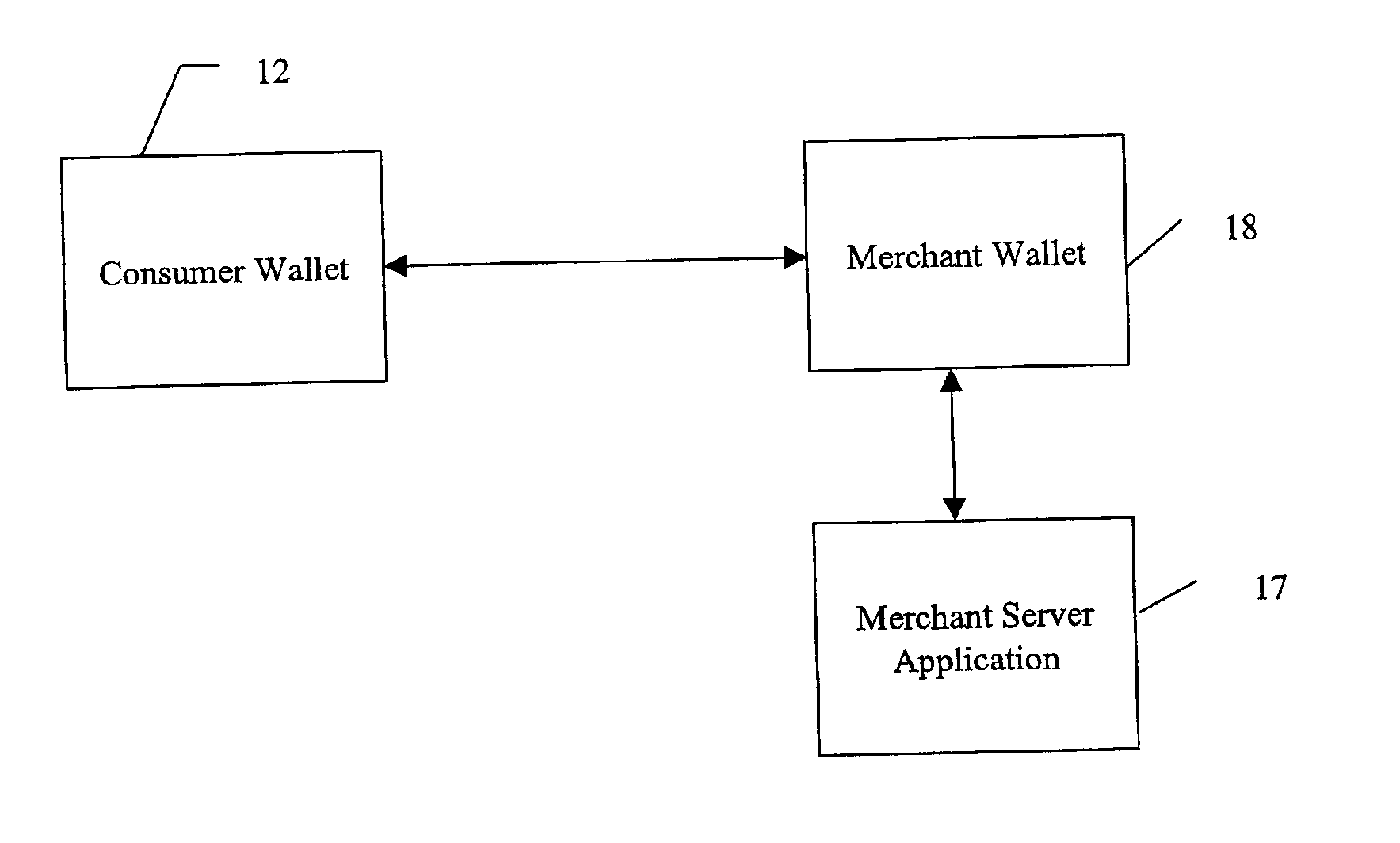

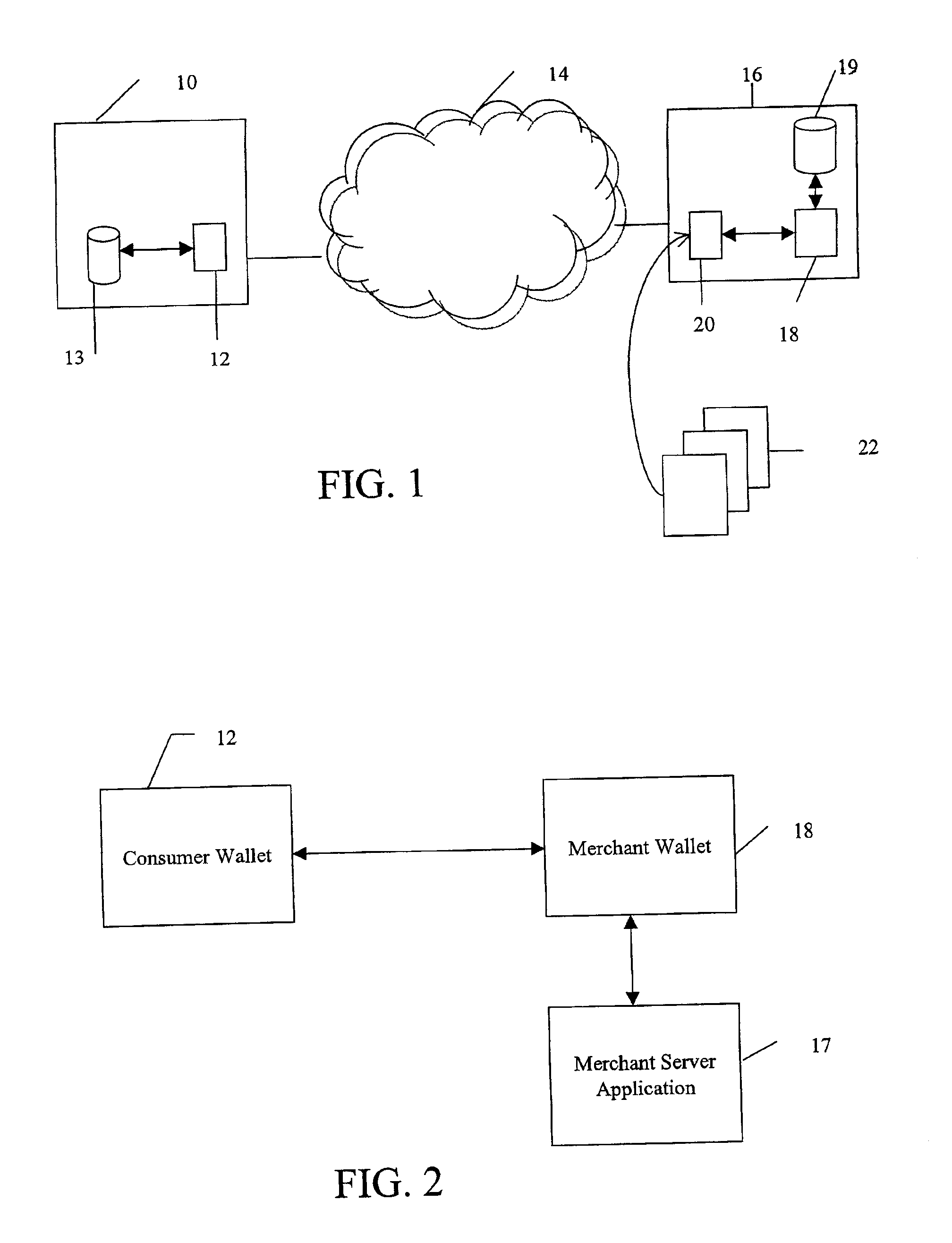

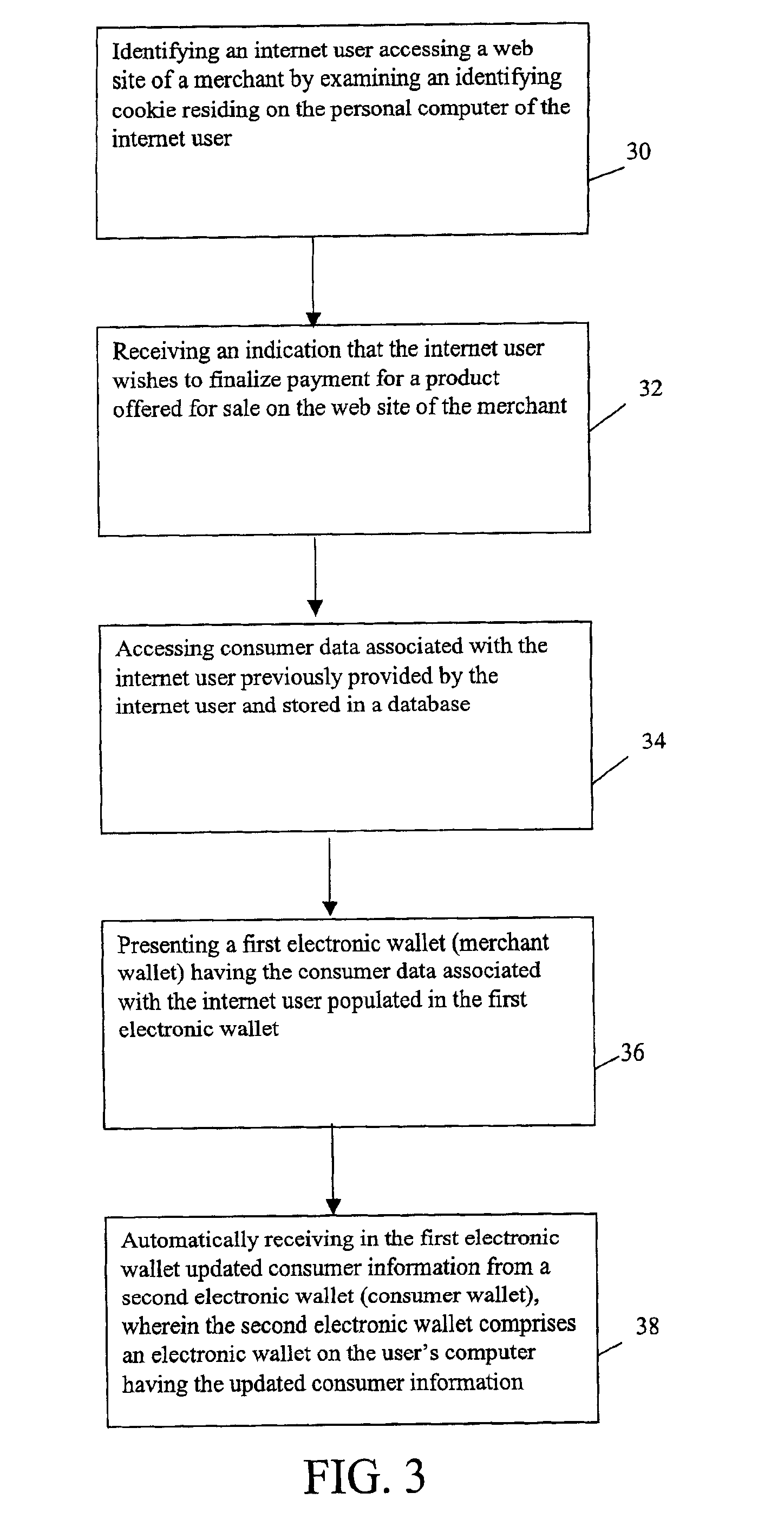

System and method for use of distributed electronic wallets

InactiveUS6873974B1Avoid burdenImprove efficiencyComplete banking machinesFinanceMerchant servicesCredit card

Methods and systems whereby two electronic wallets communicate and exchange information. In one such system, a consumer's personal electronic wallet communicates with the exclusive or preferred wallet of a web merchant. In one such system, an internet consumer registers with a web merchant's exclusive or preferred electronic wallet (“merchant wallet”) and provides consumer information (e.g., credit card number, mailing address, and other information) to the merchant wallet, which is stored by the merchant wallet in a database on the merchant server. Such information may be automatically populated by the consumer's personal electronic wallet. The consumer maintains current consumer information in a consumer electronic wallet on the consumer's personal computer. When the consumer visits the merchant site again, and orders goods or services, the merchant's preferred wallet can be automatically updated by the consumer's electronic wallet if any of the data in the merchant's wallet has changed. For example, the consumer wallet examines the information in the merchant wallet to determine if the information in the merchant wallet conforms to the current information in the consumer wallet. If the information does not conform, the consumer wallet communicates the current consumer information to the merchant wallet.

Owner:CITIBANK

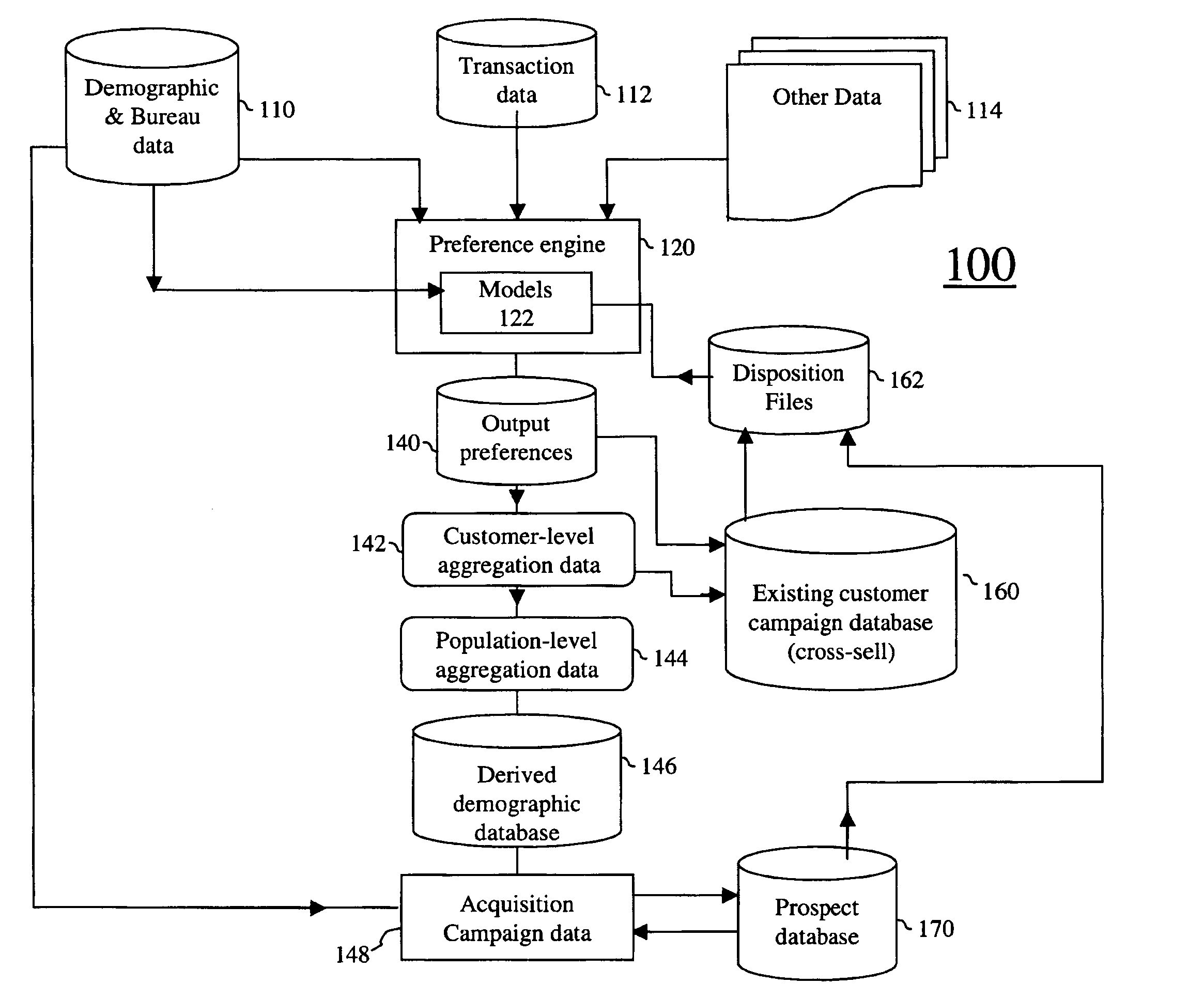

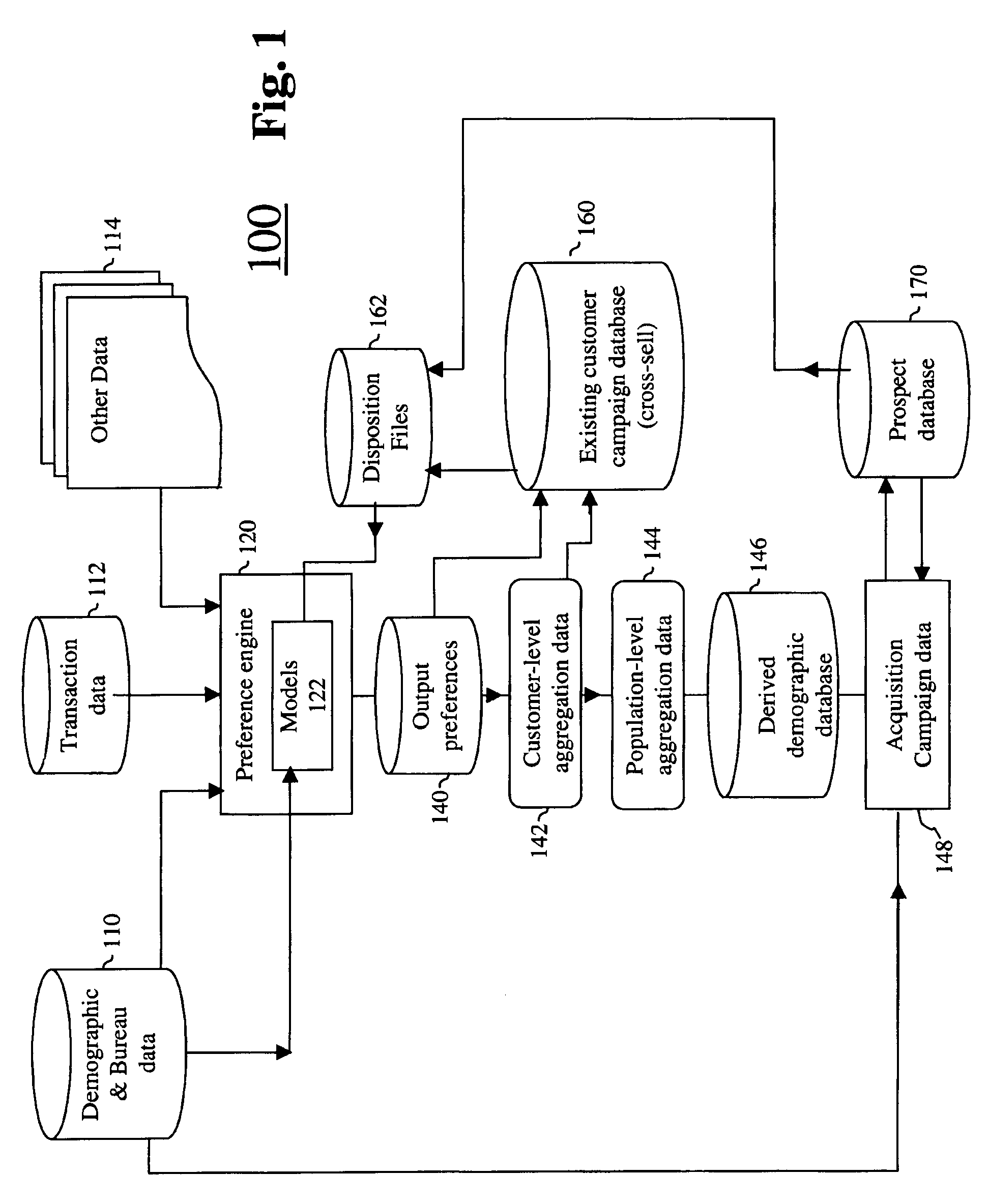

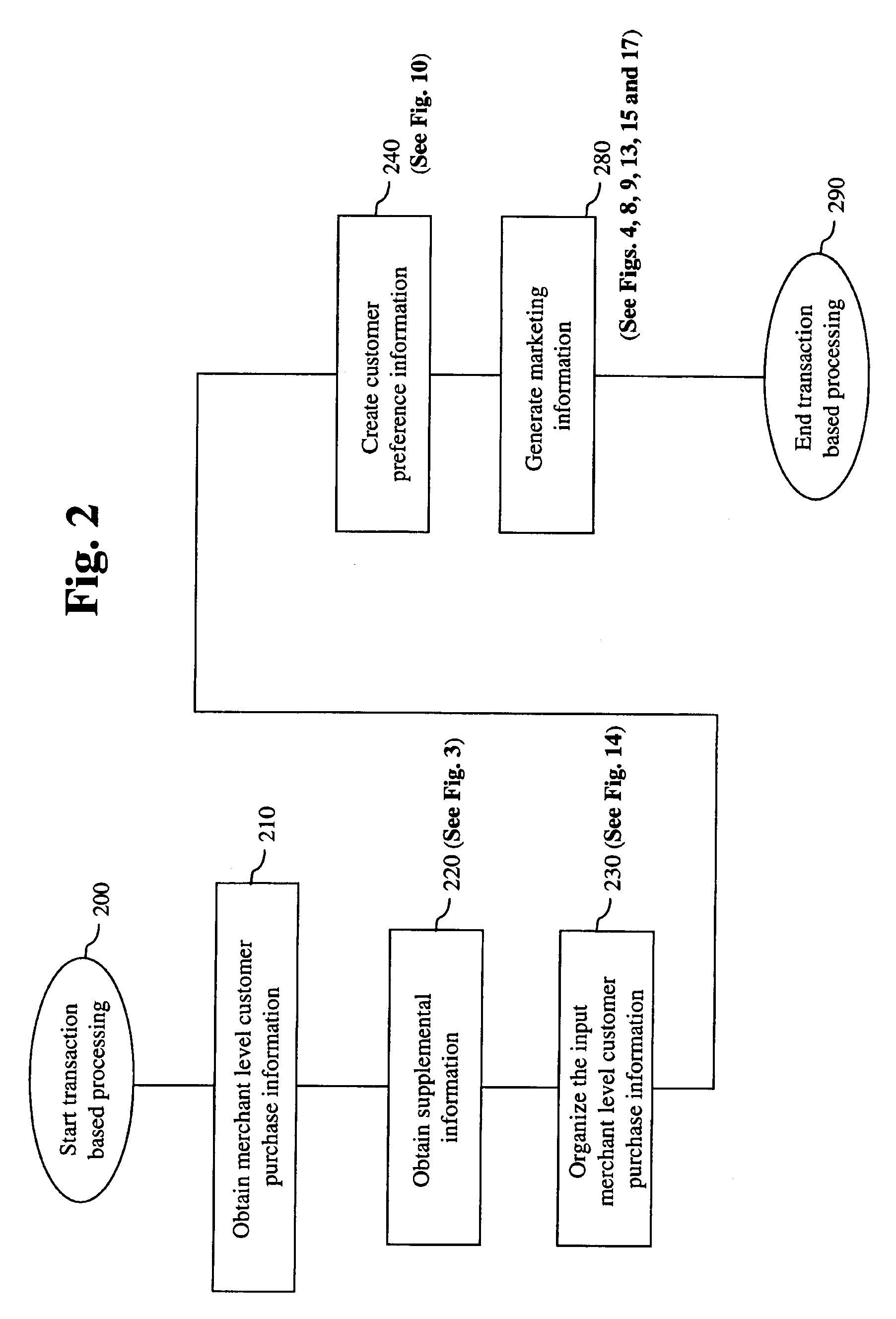

Systems And Methods For Aggregating And Utilizing Retail Transaction Records At The Customer Level

A method and system is provided for storing and manipulating customer purchase information received from a plurality of sources. A computer system may be used comprising a storage device for storing the customer purchase information and a processor for processing the customer purchase information. The method may include receiving the customer purchase information; organizing the customer purchase information within a predetermined organizational structure; creating a customer preference based at least in part on the customer purchase information; and aggregating customer purchases for merchant classes based on the customer purchase information so as to generate aggregated customer purchase information. The method may further include generating marketing information based on at least one of the customer preference and the aggregated customer purchase information.

Owner:CHASE BANK USA NAT ASSOC +1

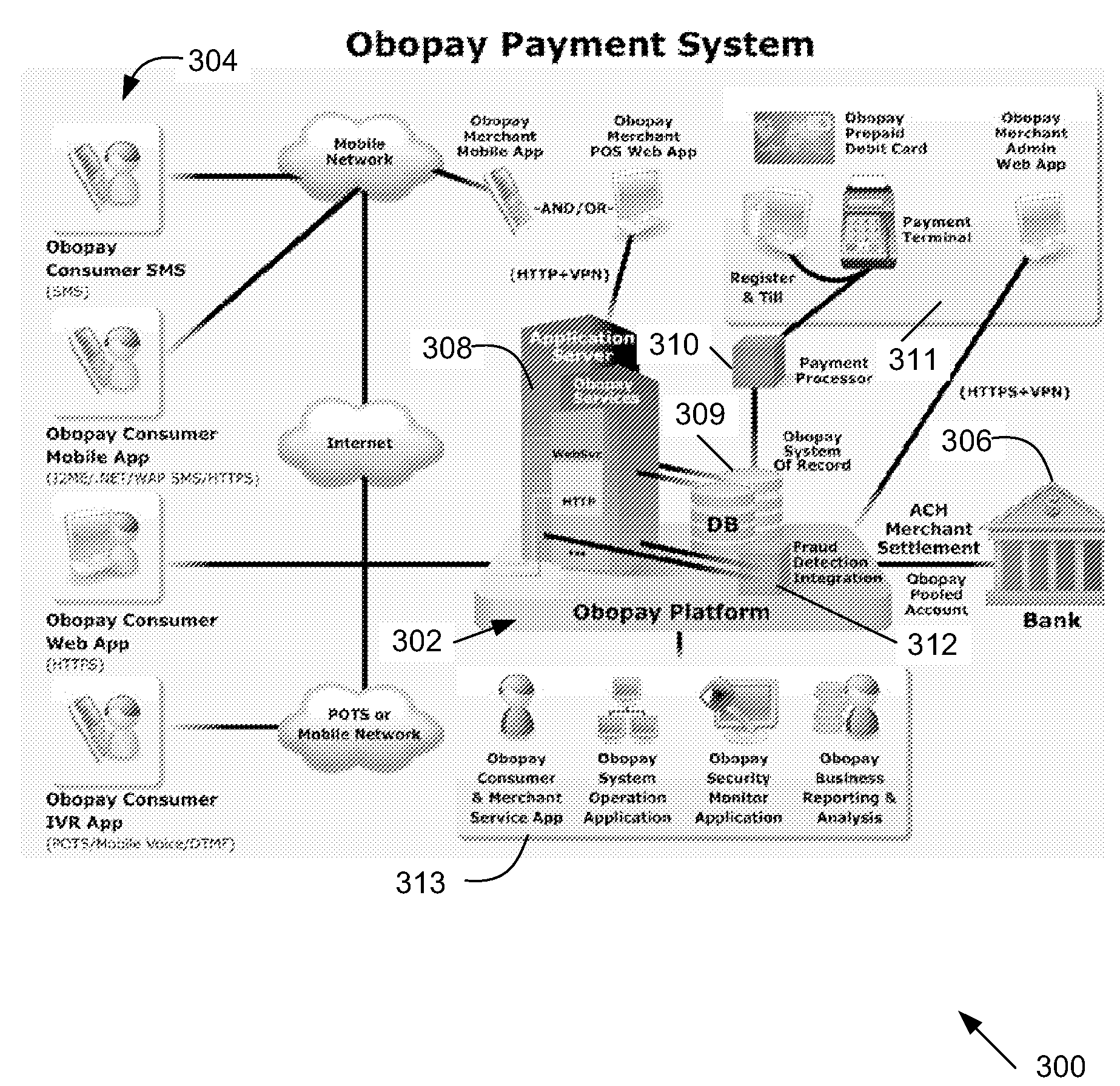

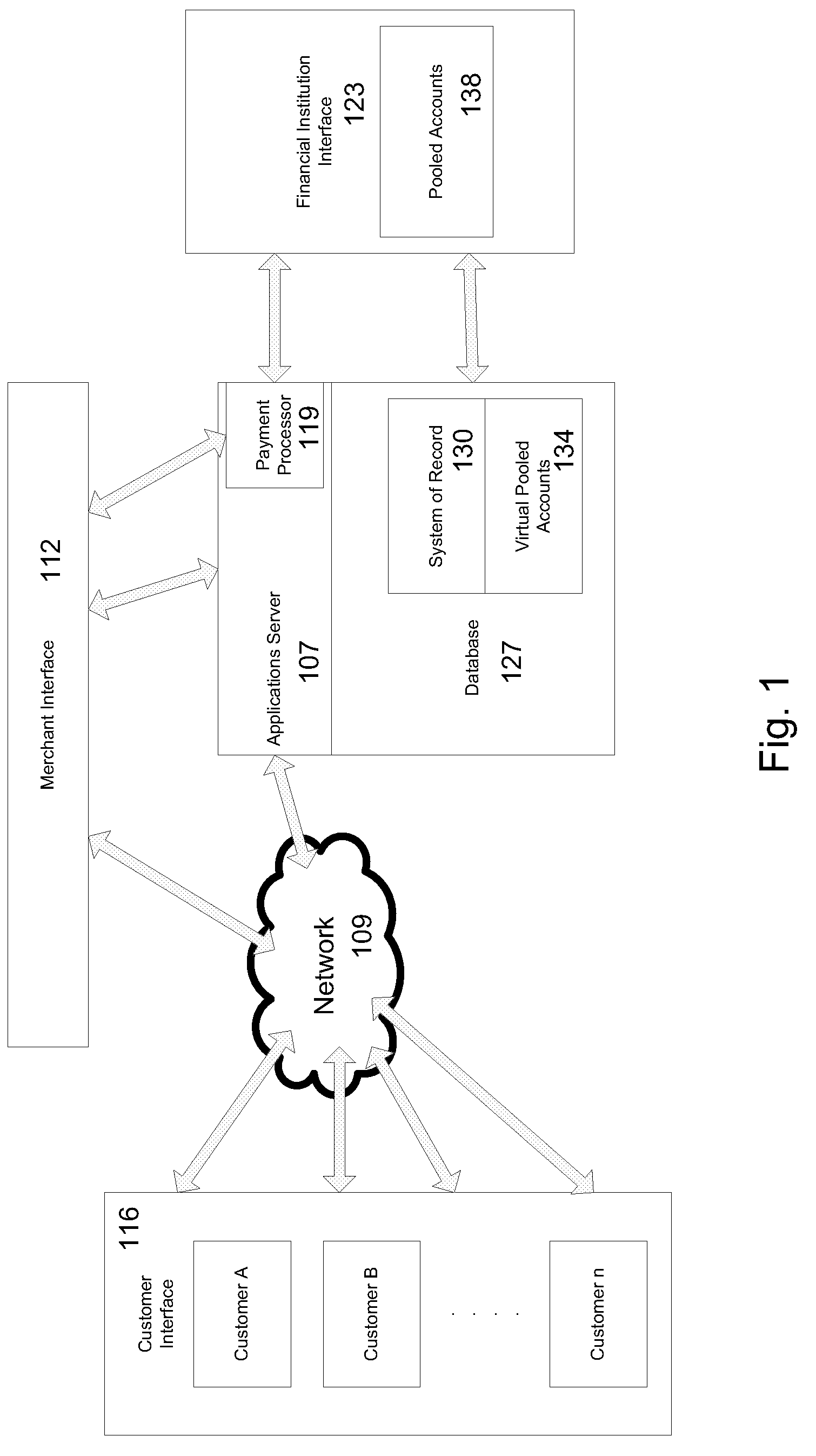

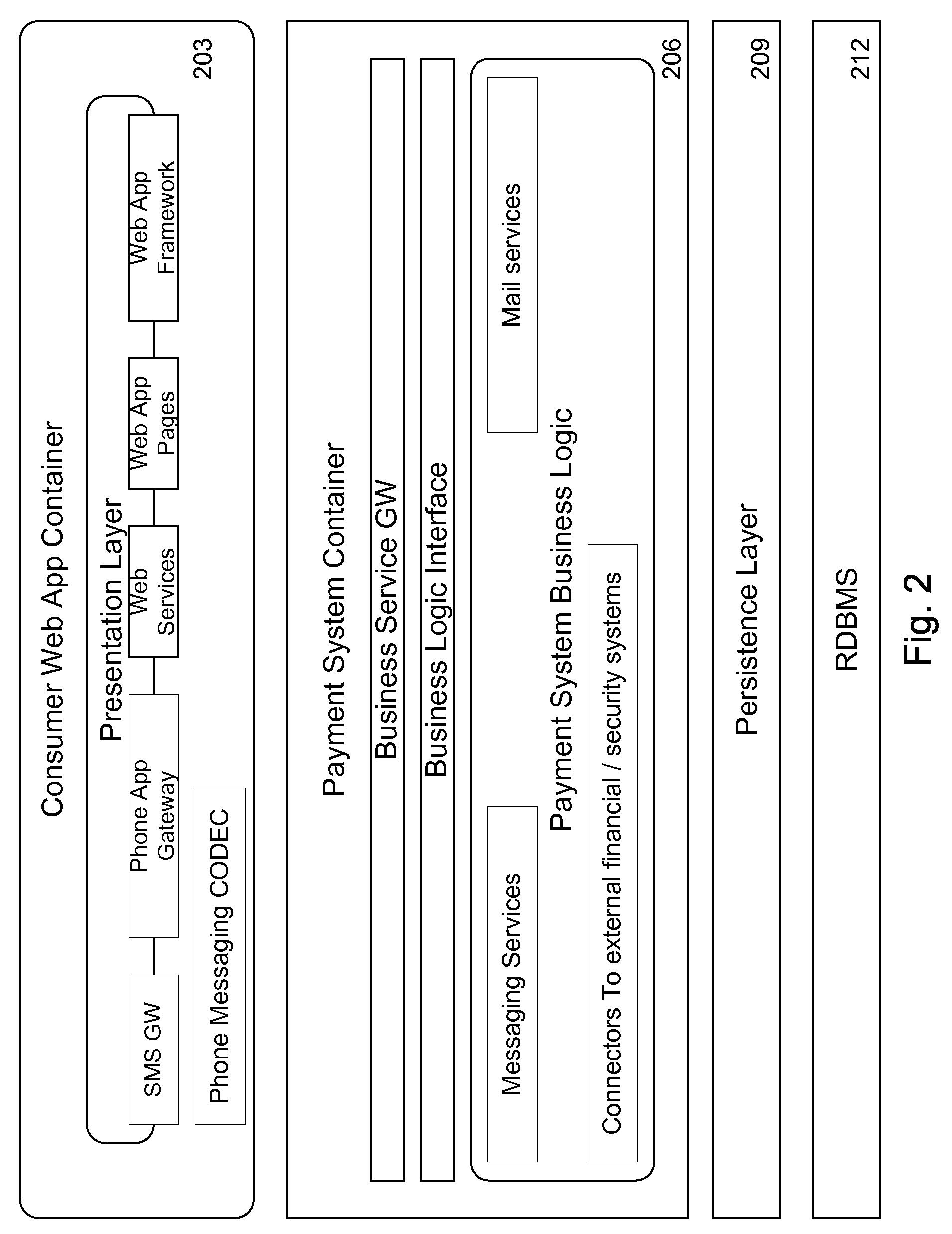

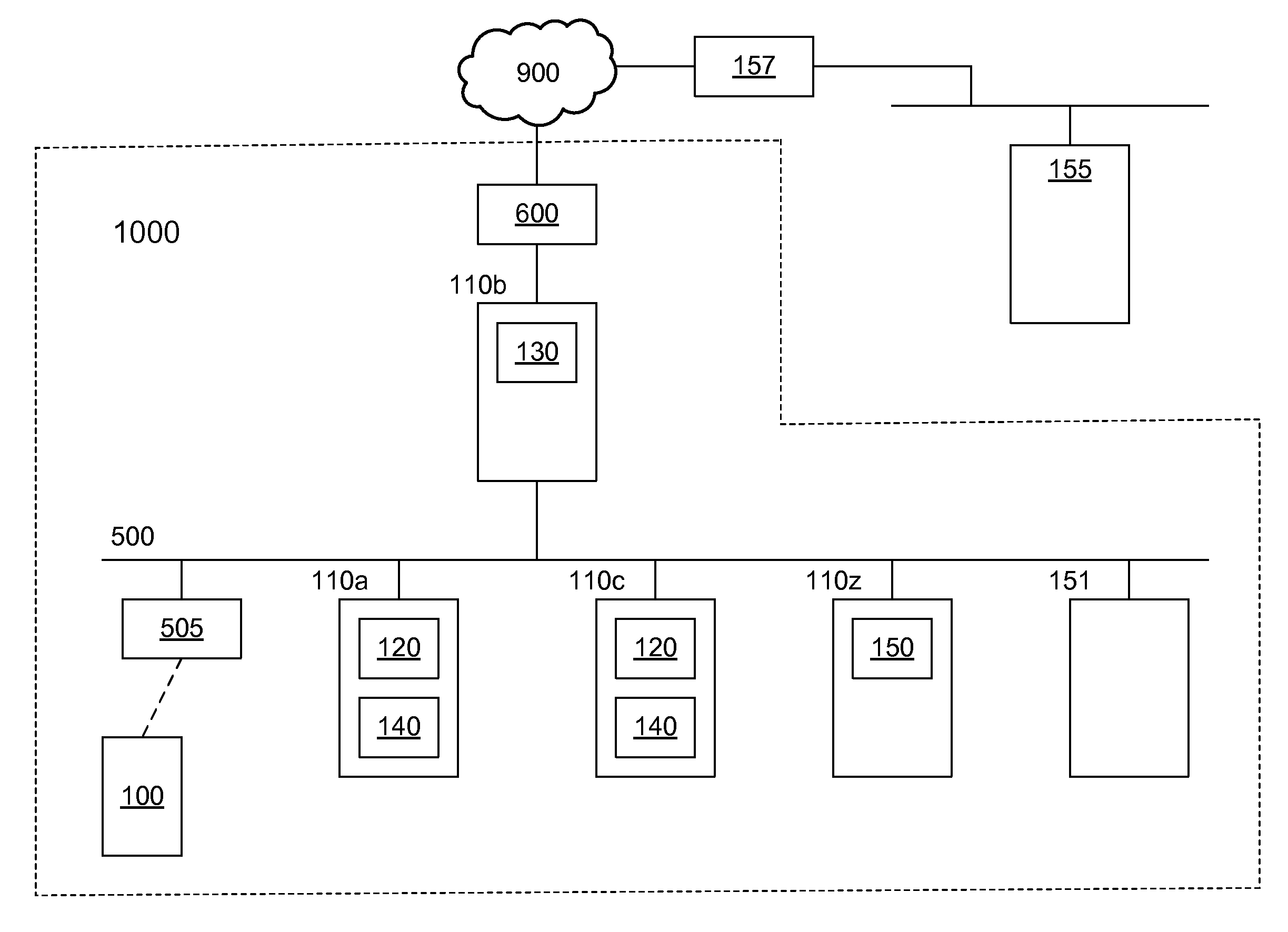

Virtual Pooled Account for Mobile Banking

InactiveUS20090119190A1Reduce settlementReduce operating costsComplete banking machinesFinanceOperational costsSimulation

A virtual pooled account is used in operating a system having multiple financial partners. In a specific implementation, the system is a mobile banking system. Instead of maintaining separate general ledgers for each financial institution, the system will keep one general virtual pooled account. This will reduce the settlement and operational costs of the system. The owner of the virtual pooled account will receive the float on the virtual pooled account, and this float will be distributed to the multiple financial partners according to a formula.

Owner:OBOPAY MOBILE TECH INDIA PTE LTD

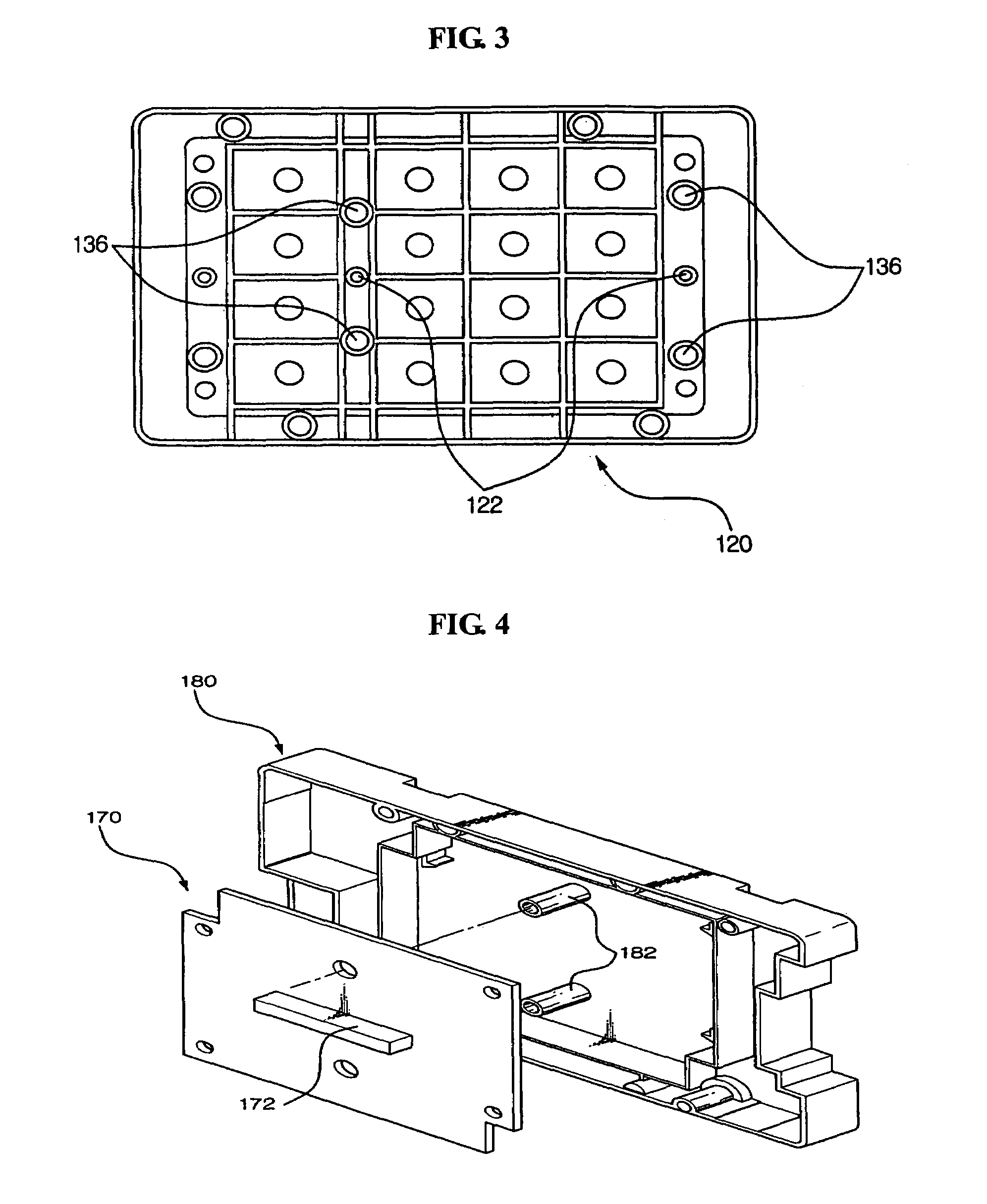

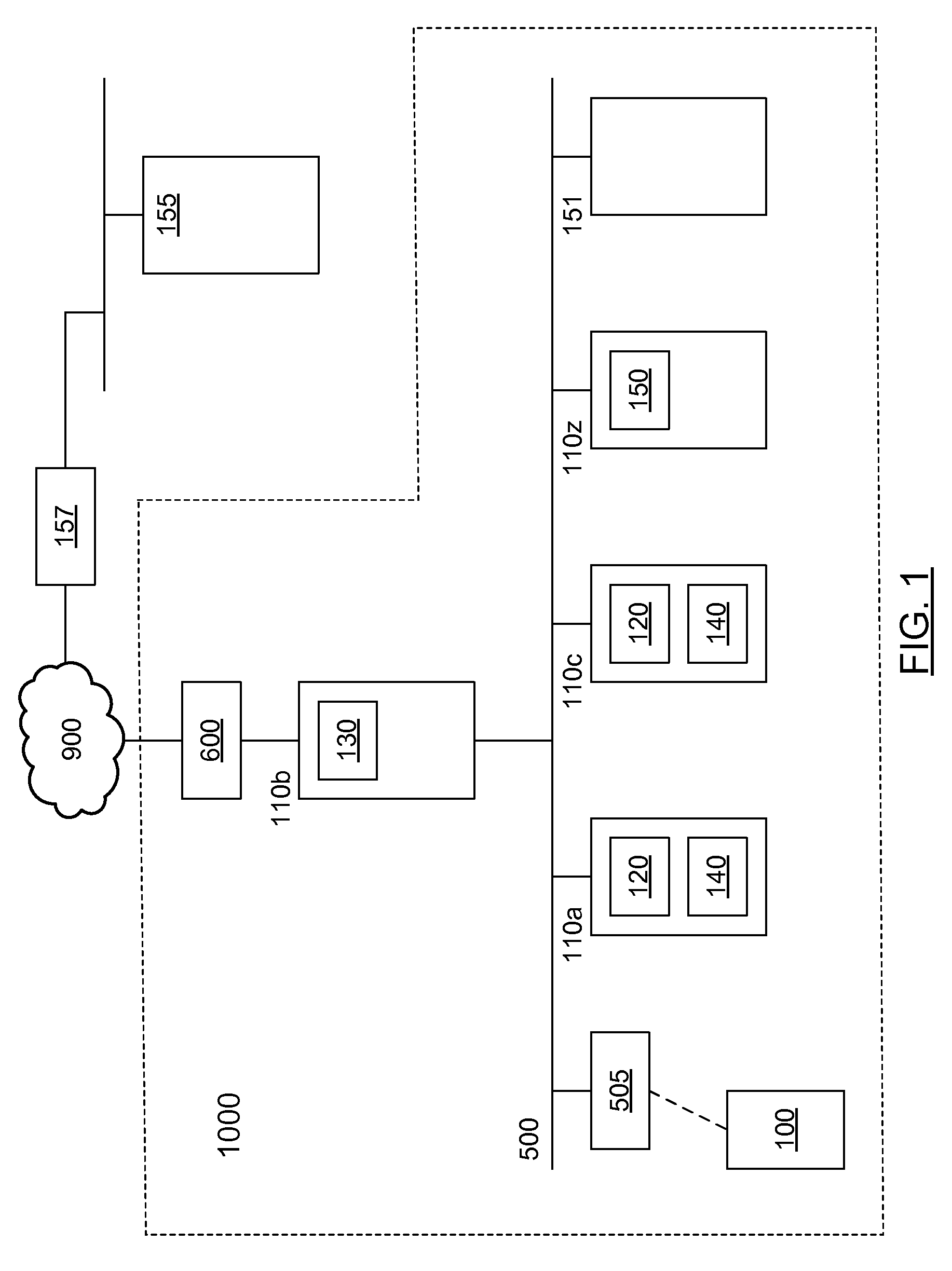

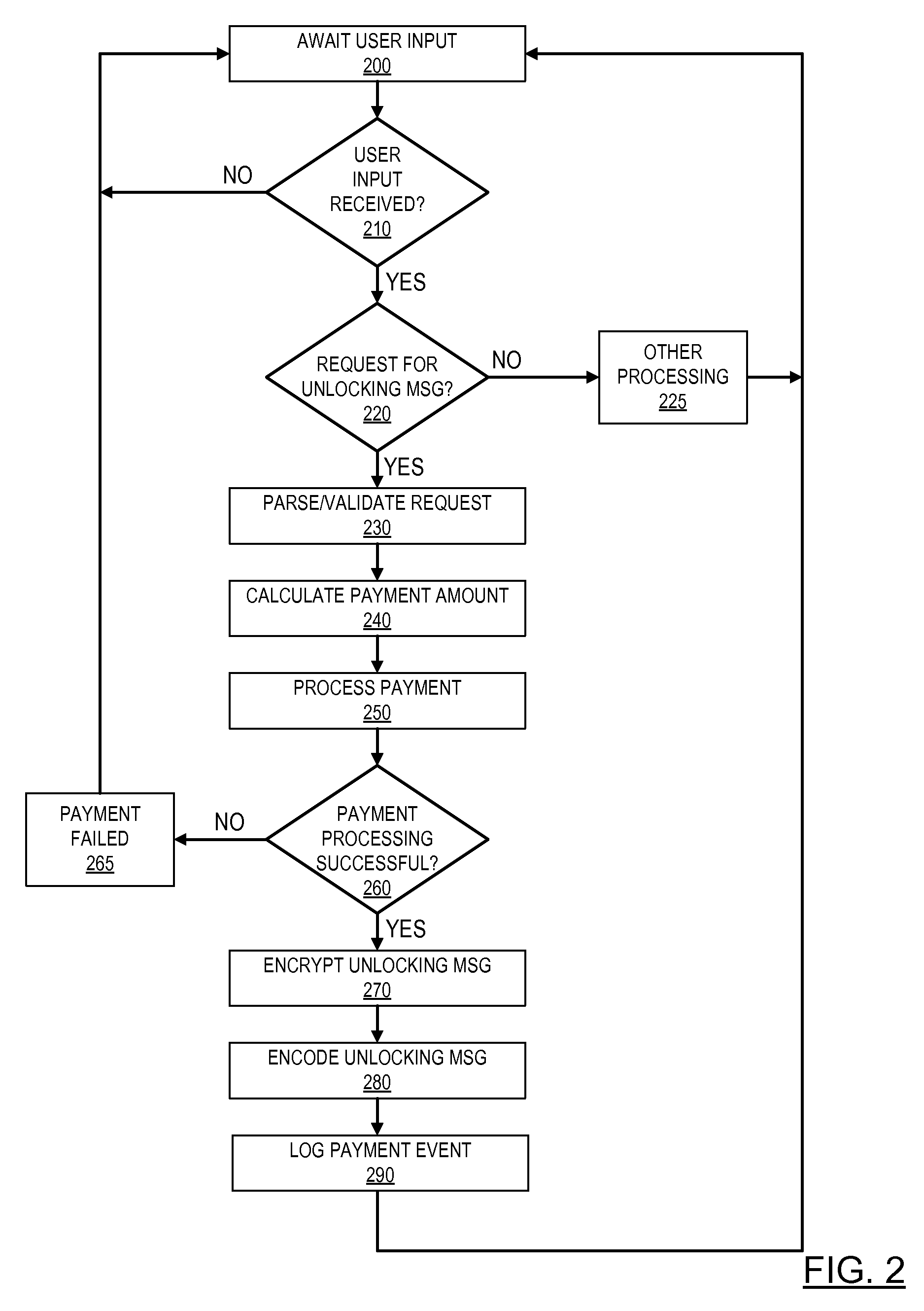

Pre-paid usage system for encoded information reading terminals

A fleet management system for managing a fleet of encoded information reading (EIR) terminals can comprise one or more computers, a fleet management software module, and a payment processing software module in communication with the fleet management software module. The fleet management software module can be configured, responsive to receiving a customer initiated request, to generate an unlocking message upon processing a payment by the payment processing software module. The unlocking message can be provided by a bar code to be read by an EIR terminal, or by a bit stream to be transferred to an EIR terminal via network. Each EIR terminal can be configured to perform not more than a pre-defined number of EIR operations responsive to receiving the unlocking message.

Owner:METROLOGIC INSTR

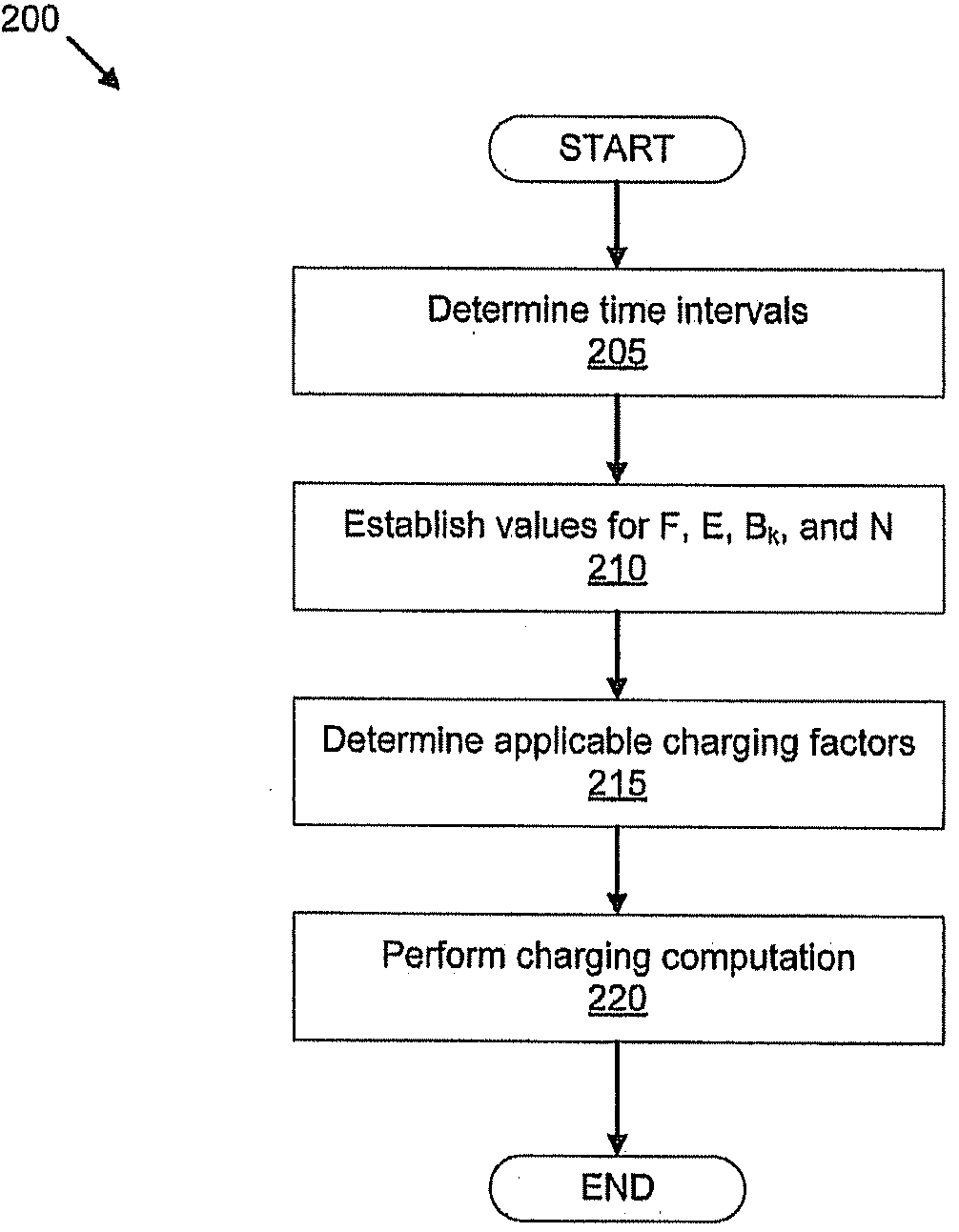

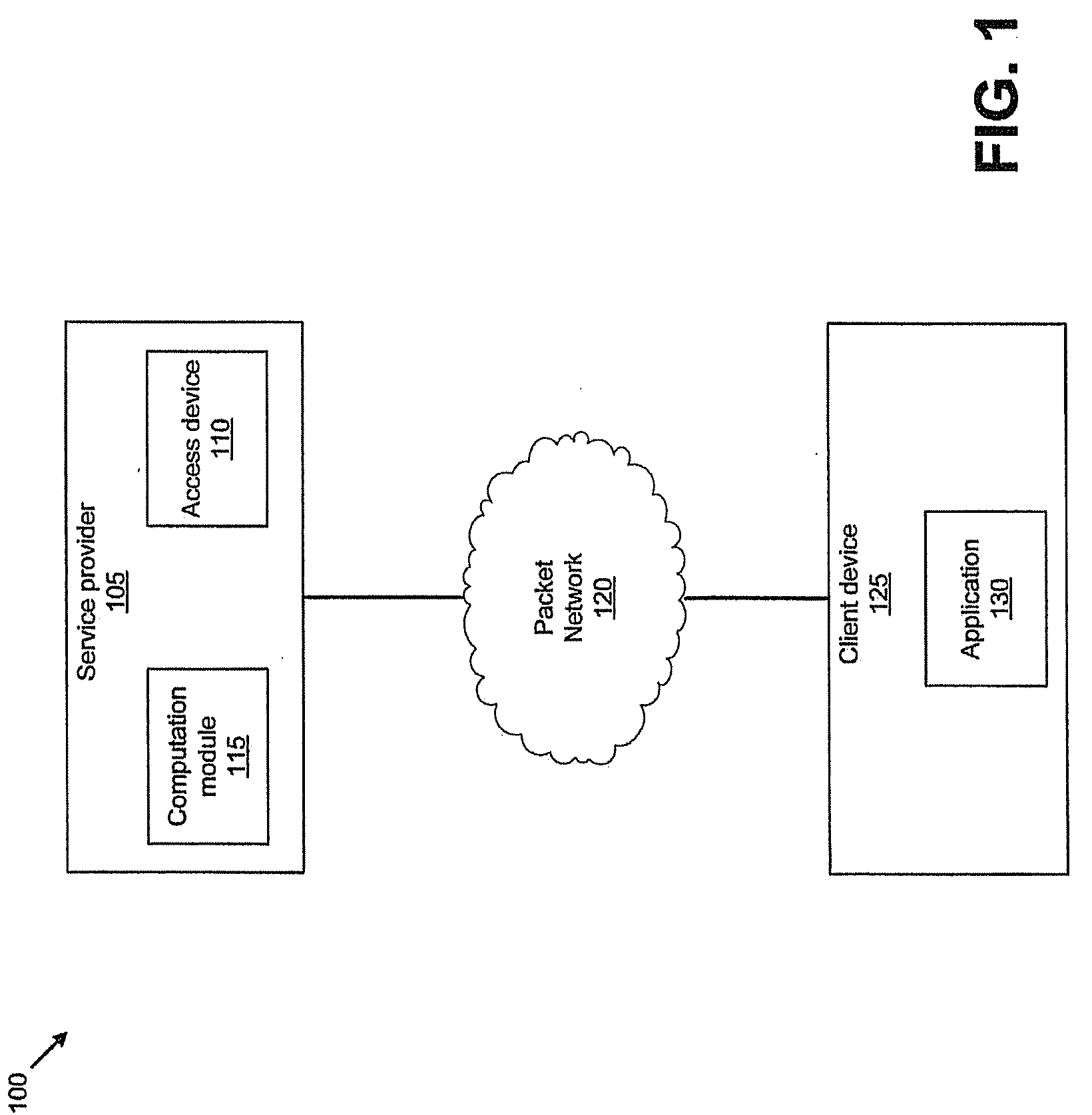

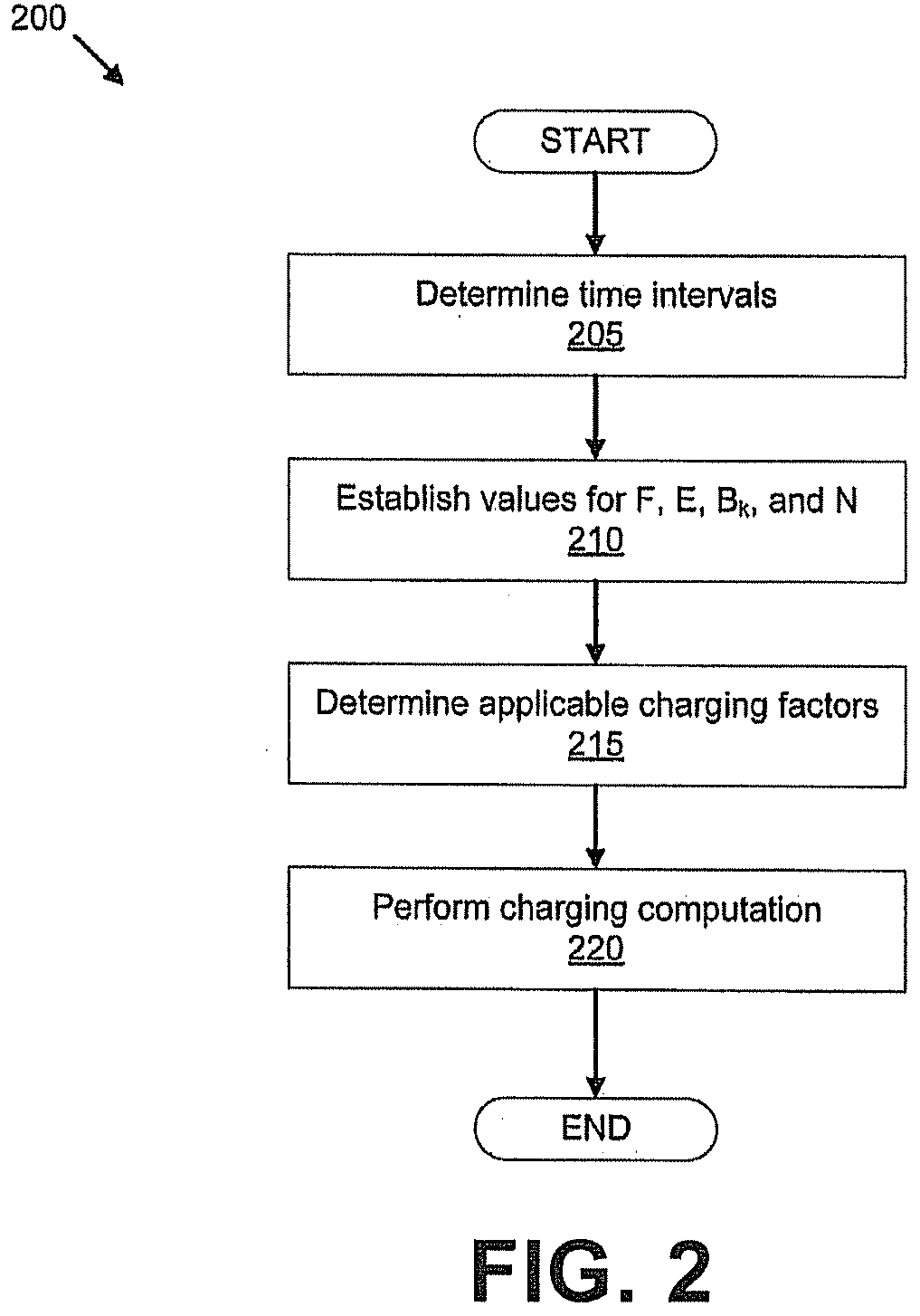

Data metering

InactiveUS20090132400A1Complete banking machinesMetering/charging/biilling arrangementsStart timeData transmission

A charging factor is determined applicable to each time interval in a period of time during which at least one data transfer was conducted. An amount of data transferred during each time interval is determined. A total charge applicable to the at least one data transfer is computed based at least in part on the charging factor applicable to each time interval and the amount of data transferred. Alternatively or additionally, a plurality of potential start times and an amount of data for a data transfer are identified. A set of time intervals associated with each of the potential start times are determined. For each of the potential start times, an estimated charge applicable to the data transfer is computed based at least in part on a charging factor applicable to each of one or more time intervals associated with the potential start time and the amount of data estimated to be transferred.

Owner:VERIZON PATENT & LICENSING INC

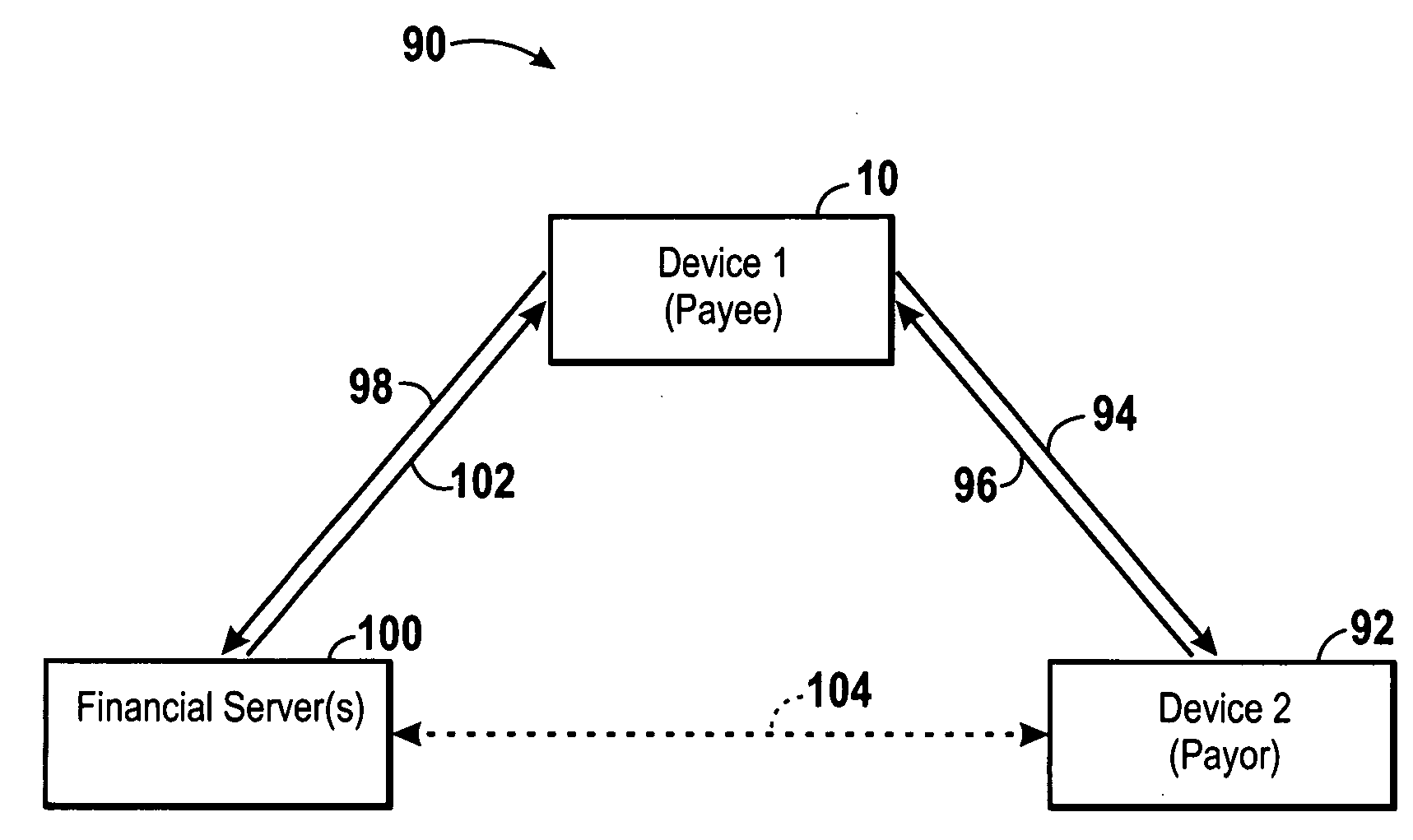

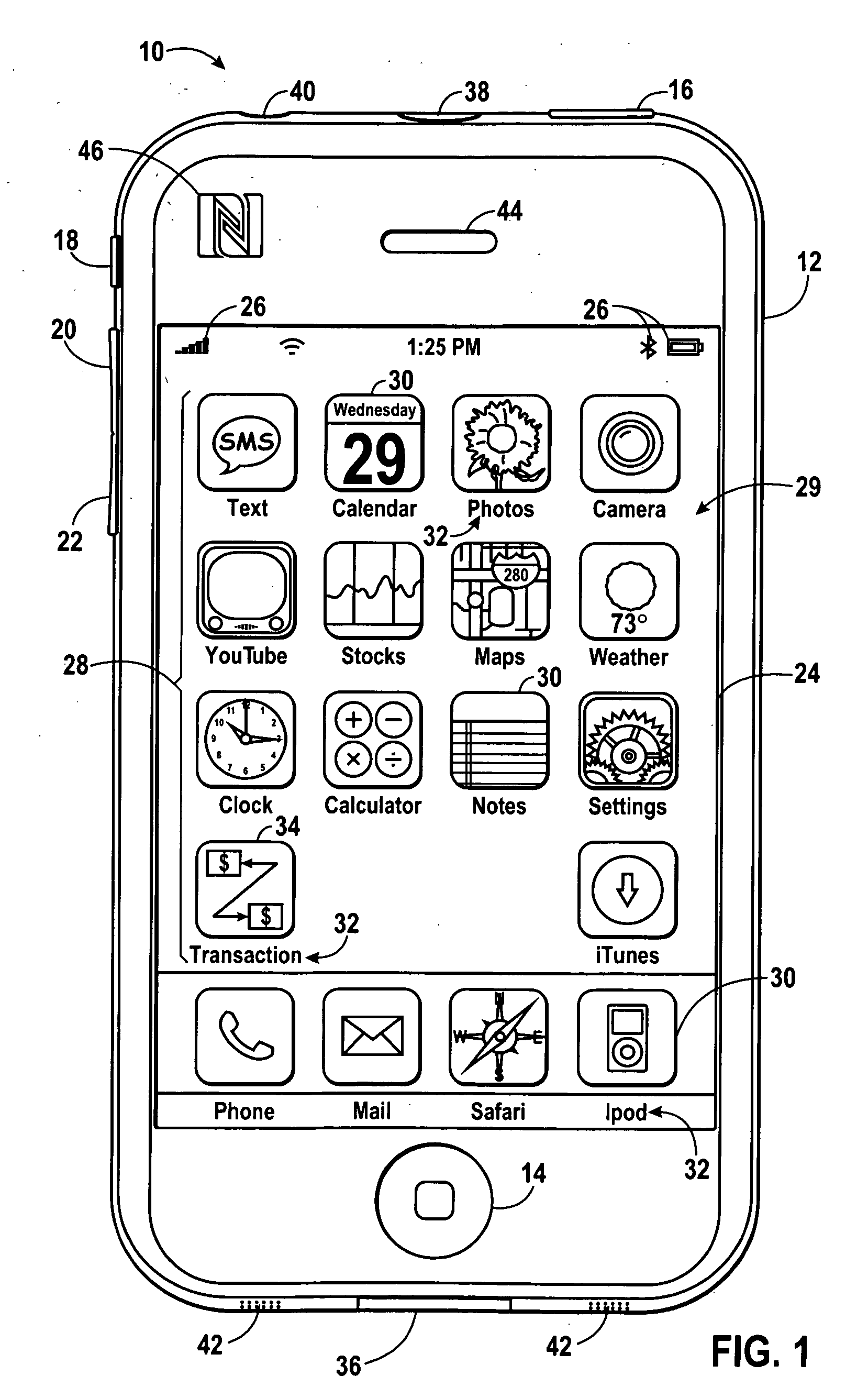

System and method for processing peer-to-peer financial transactions

Various techniques are provided for carrying out peer-to-peer financial transactions using one or more electronic devices. In one embodiment, a request for payment is transmitted from a first device to a second device using a near field communication (NFC) interface. In response to the request, the second device may transmit payment information to the first device. The first device may select a crediting account and, using a suitable communication protocol, may communicate the received payment information and selected crediting account to one or more external financial servers configured to process and determine whether the payment may be authorized. If the payment is authorized, a payment may be credited to the selected crediting account. In a further embodiment, a device may include a camera configured to obtain an image of a payment instrument. The device may further include an application to extract payment information from the acquired image.

Owner:APPLE INC

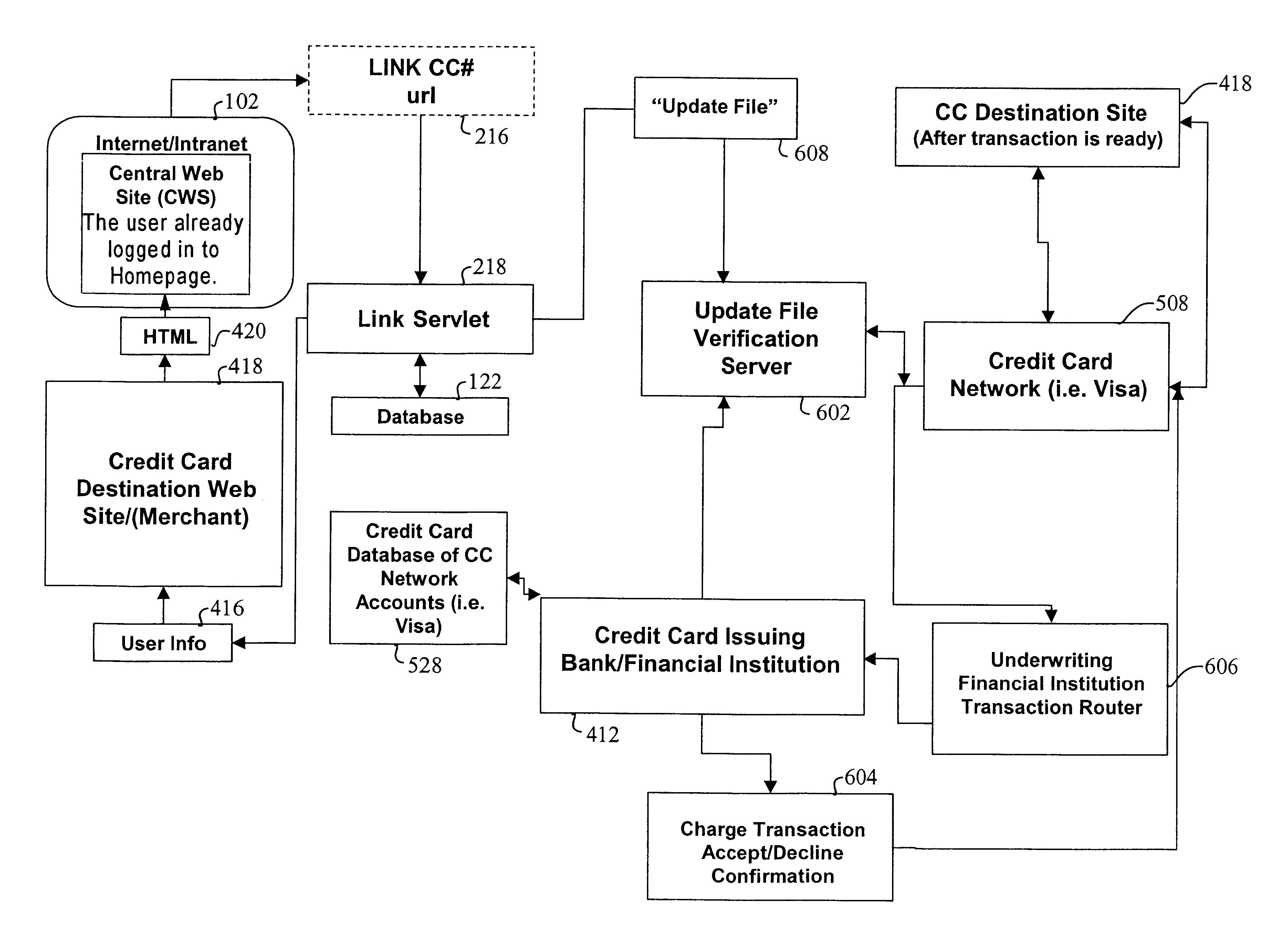

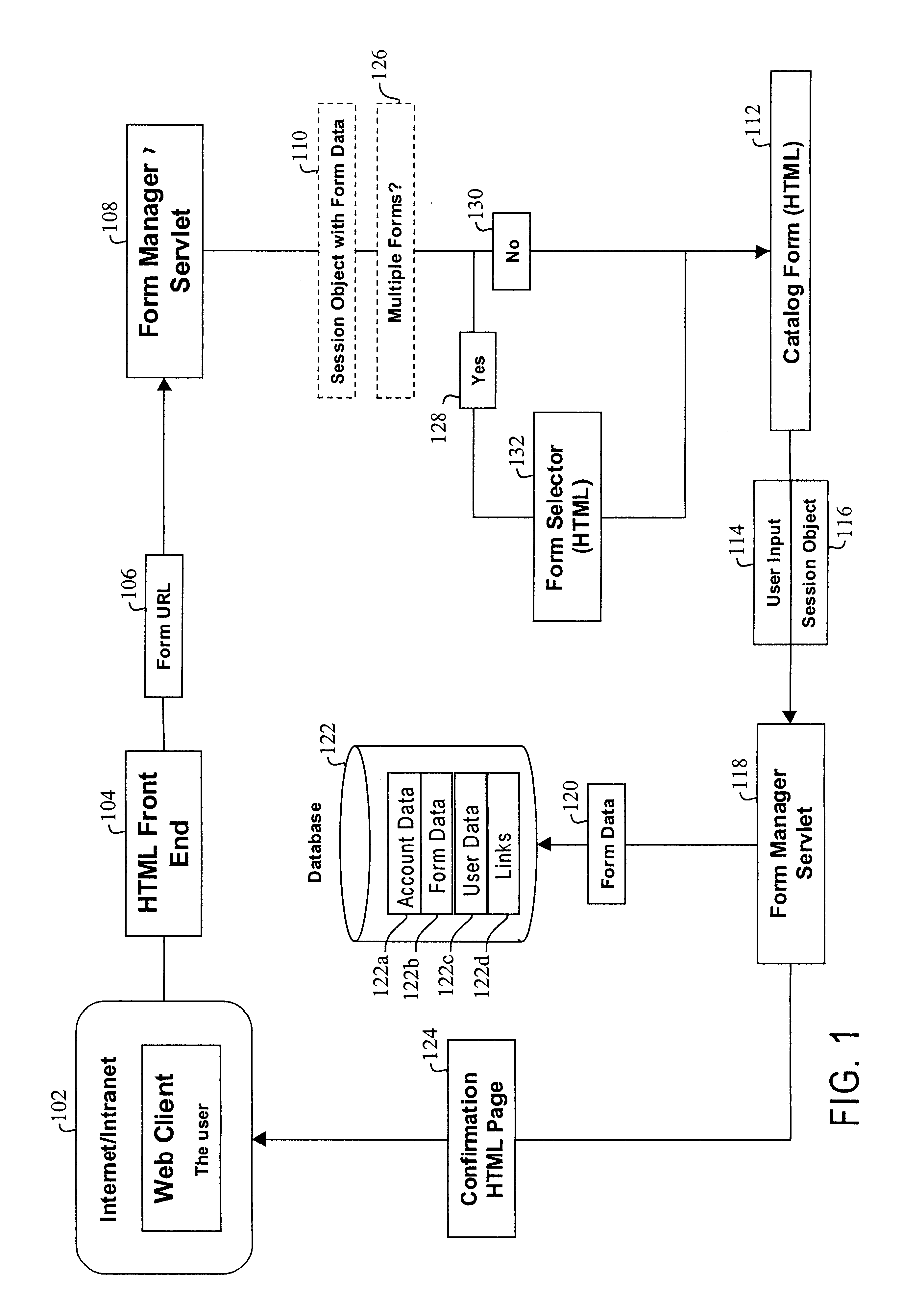

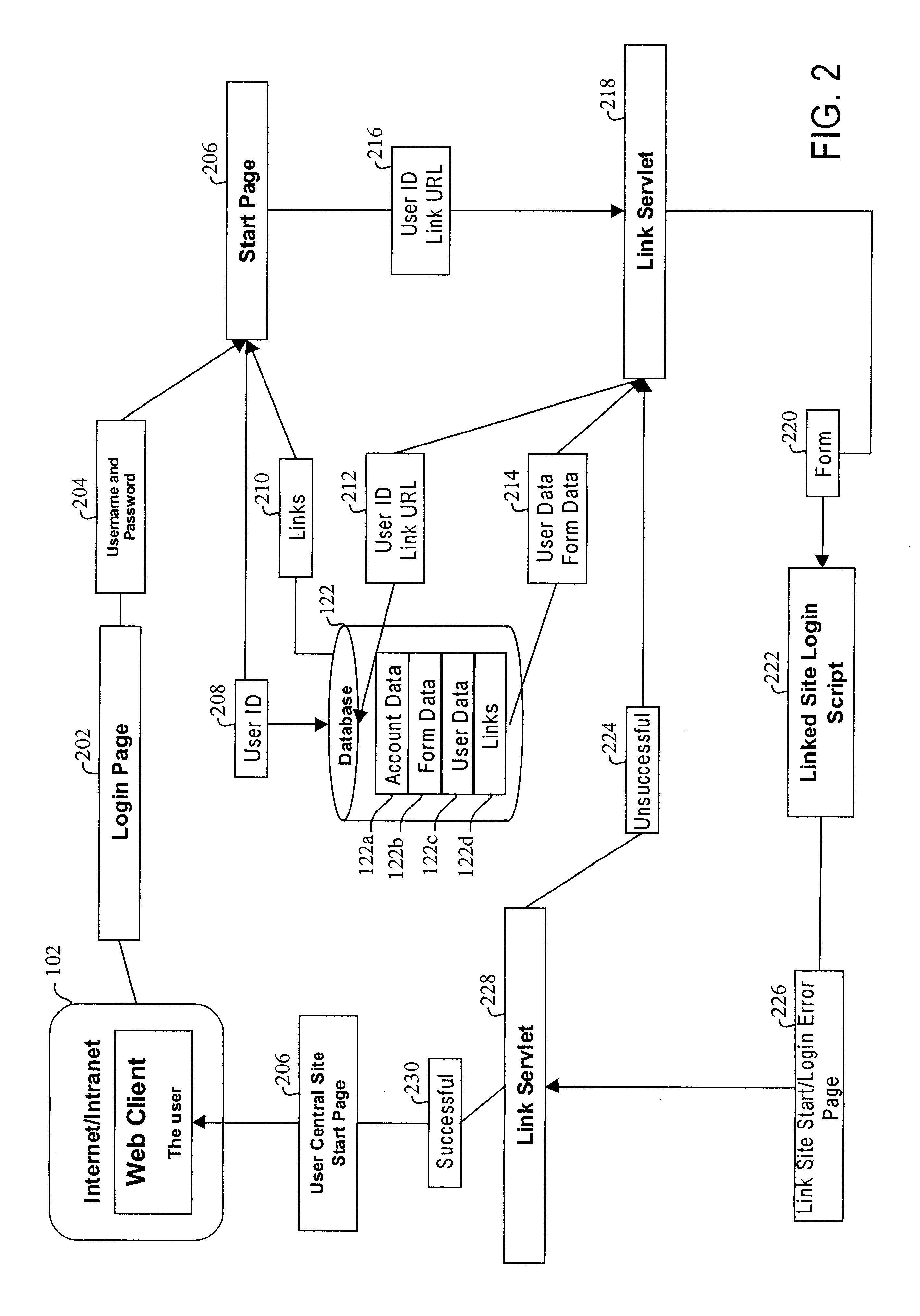

Method, system and computer readable medium for web site account and e-commerce management from a central location

InactiveUS6879965B2Minimizing activation timeMinimizing financial exposureComplete banking machinesAcutation objectsWeb siteData field

A method, system and computer readable medium for, from a central Web site, performing at least one of registering a user at a destination Web site, logging in a user at a destination Web site and managing an online financial transaction at a destination Web site, including parsing a form Web page of the destination Web site to extract form data fields therefrom; mapping form data fields of a central Web site form to corresponding extracted form data fields of the form Web page of the destination Web site; and using the mapped form data fields to perform at least one of registering a user at the destination Web site, logging in a user at the destination Web site and managing an online financial transaction of a user at the destination Web site. In another aspect, there is provided a method, system and computer readable medium for managing an online or offline financial transaction of a user, from a central Web site, including generating financial transaction account information for a user based on existing credit or debit card information; gathering from the user one or more limits that are applied to a financial transaction performed based on the financial transaction account information; receiving from a source information indicating that an online or offline financial transaction using the financial transaction account information is in progress; applying the one or more limits gathered from the user to approve or disapprove the online or offline or online financial transaction that is in progress; and transmitting an approval or disapproval signal to the source based on a result of the applying step.

Owner:SLINGSHOT TECH LLC

Wireless electronic check deposit scanning and cashing machine with web-based online account cash management computer application system

Wireless Electronic Check Deposit Scanning and Cashing Machine (also known and referred to as WEDS) Web-based Online account cash Management computer application System (also known and referred to as OMS virtual / live teller)—collectively invented integrated as “WEDS.OMS” System. Method and Apparatus for Depositing and Cashing Ordinary paper and / or substitute checks and money orders online Wirelessly from home / office computer, laptop, Internet enabled mobile phone, pda (personal digital assistant) and / or any Internet enabled device. WEDS enables verification and transmittal of image, OMS is the navigation tool used to set commands and process requests, integrated with WEDS, working collectively as WEDS.OMS System.

Owner:USAA

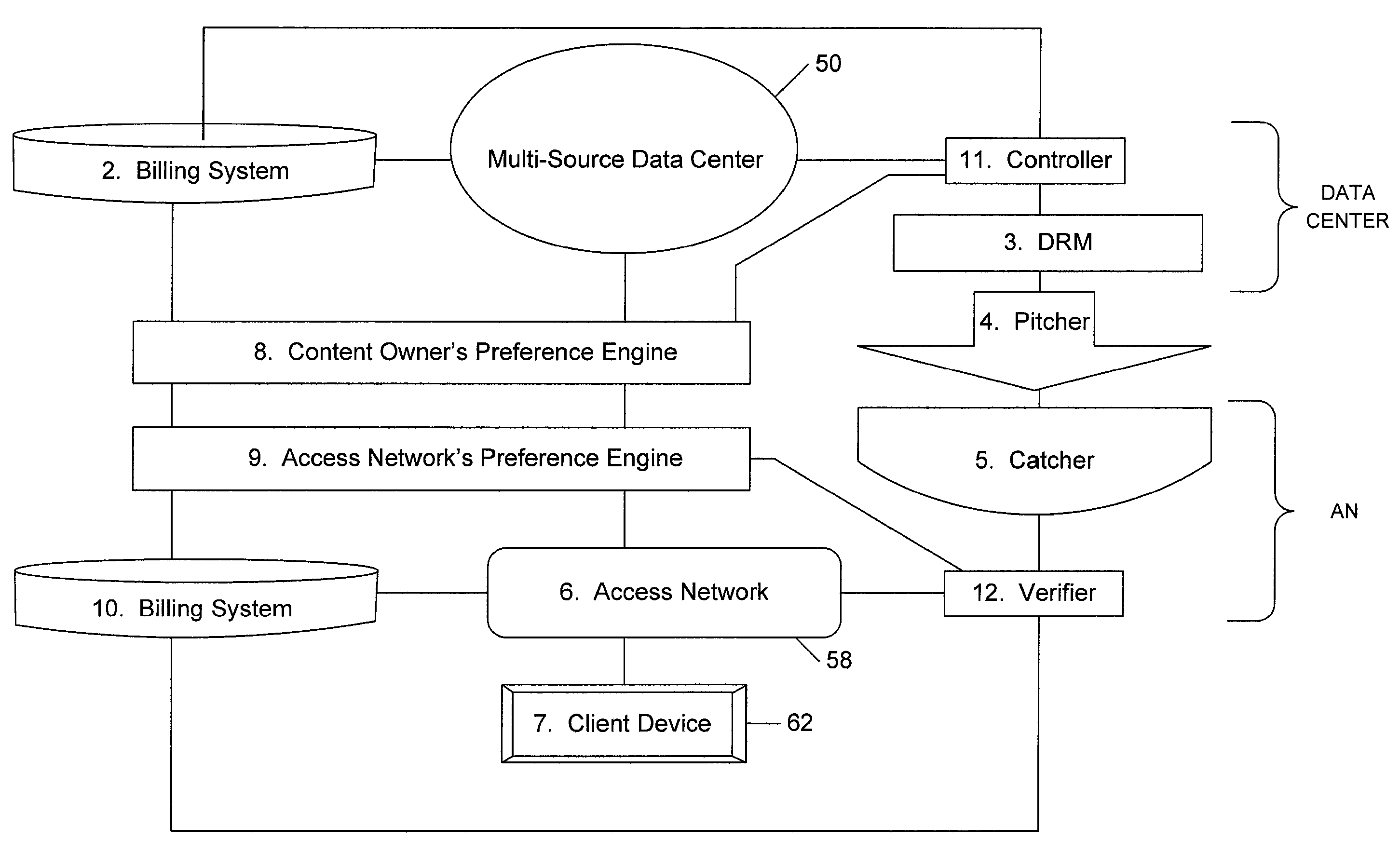

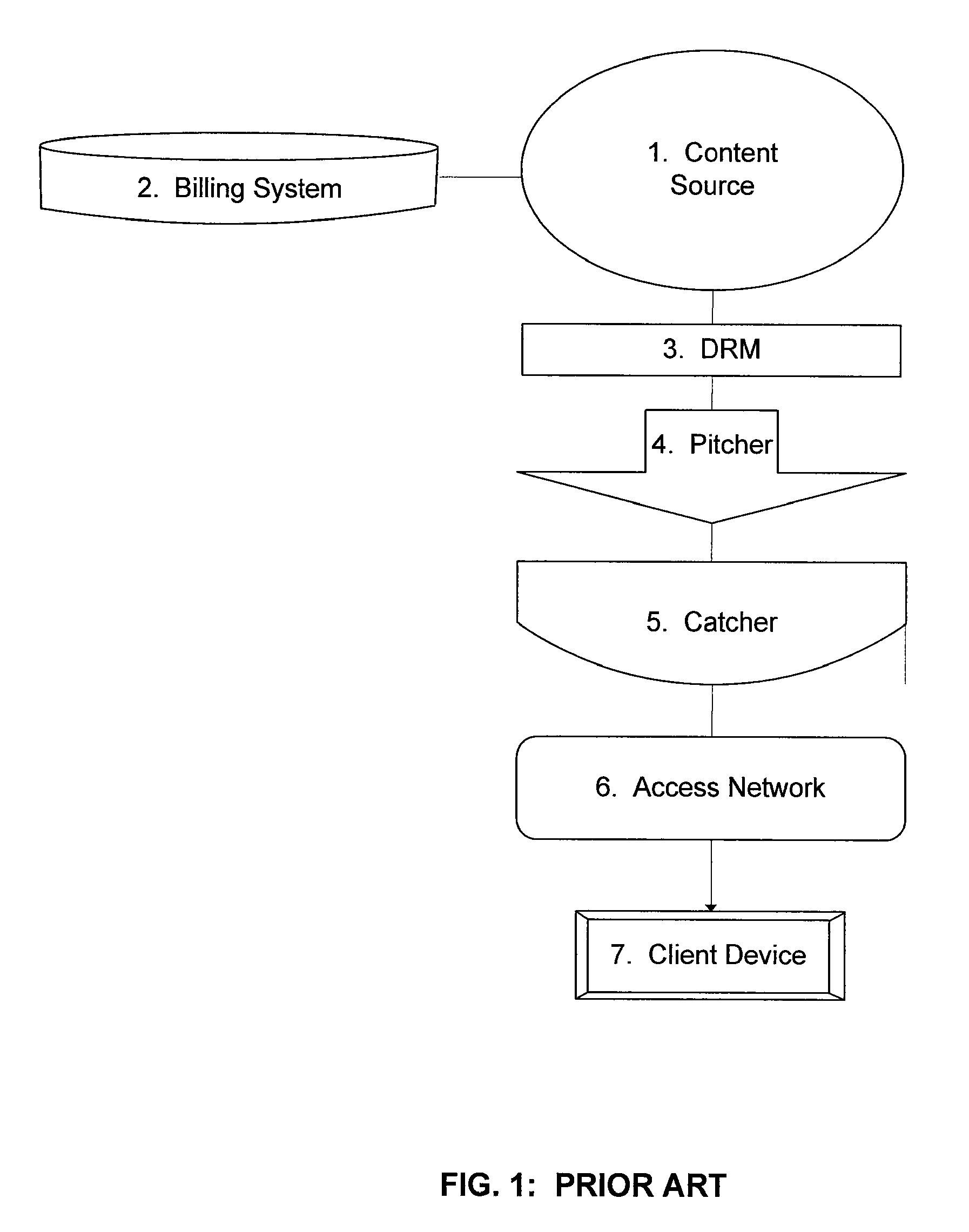

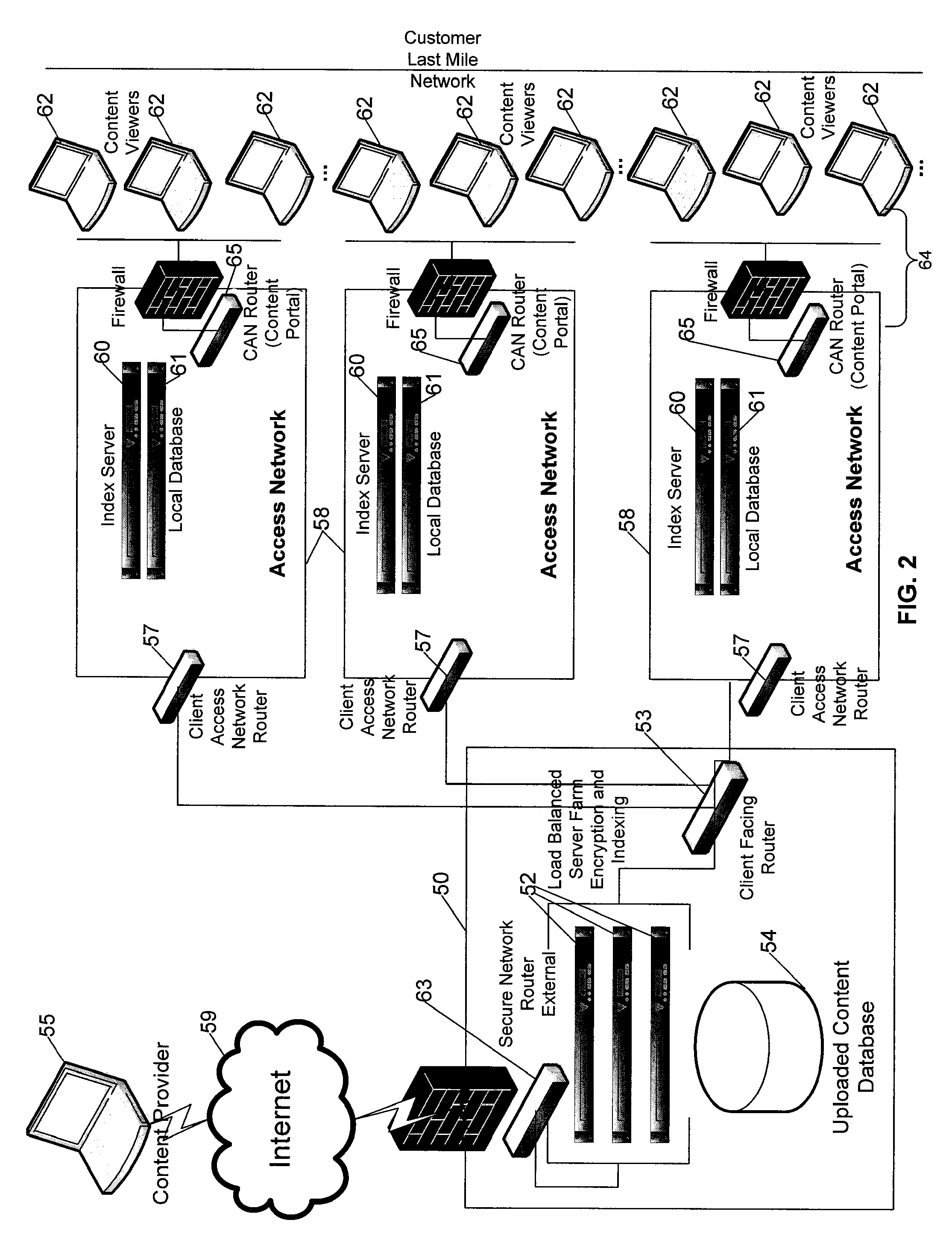

Multi-source bridge content distribution system and method

ActiveUS20080155614A1Appropriately sharedComplete banking machinesAdvertisementsContent distributionAccess network

A multi-source bridge content distribution system links multiple content owners with access network operators or content distribution providers leasing space on access networks so that multi-media content can be provided from multiple content owners to consumers through a multi-source bridge or data center. Content files and associated content owner preference settings are provided from a plurality of content sources or providers to the multi-source data center. Files stored at the data center or locally at an access network are provided to subscribers through the local access network Content files are provided if the content owner preference settings are a sufficient match with service provider access network preference settings set up by the service provider using the access network to provide content to subscribers.

Owner:VERIMATRIX INC

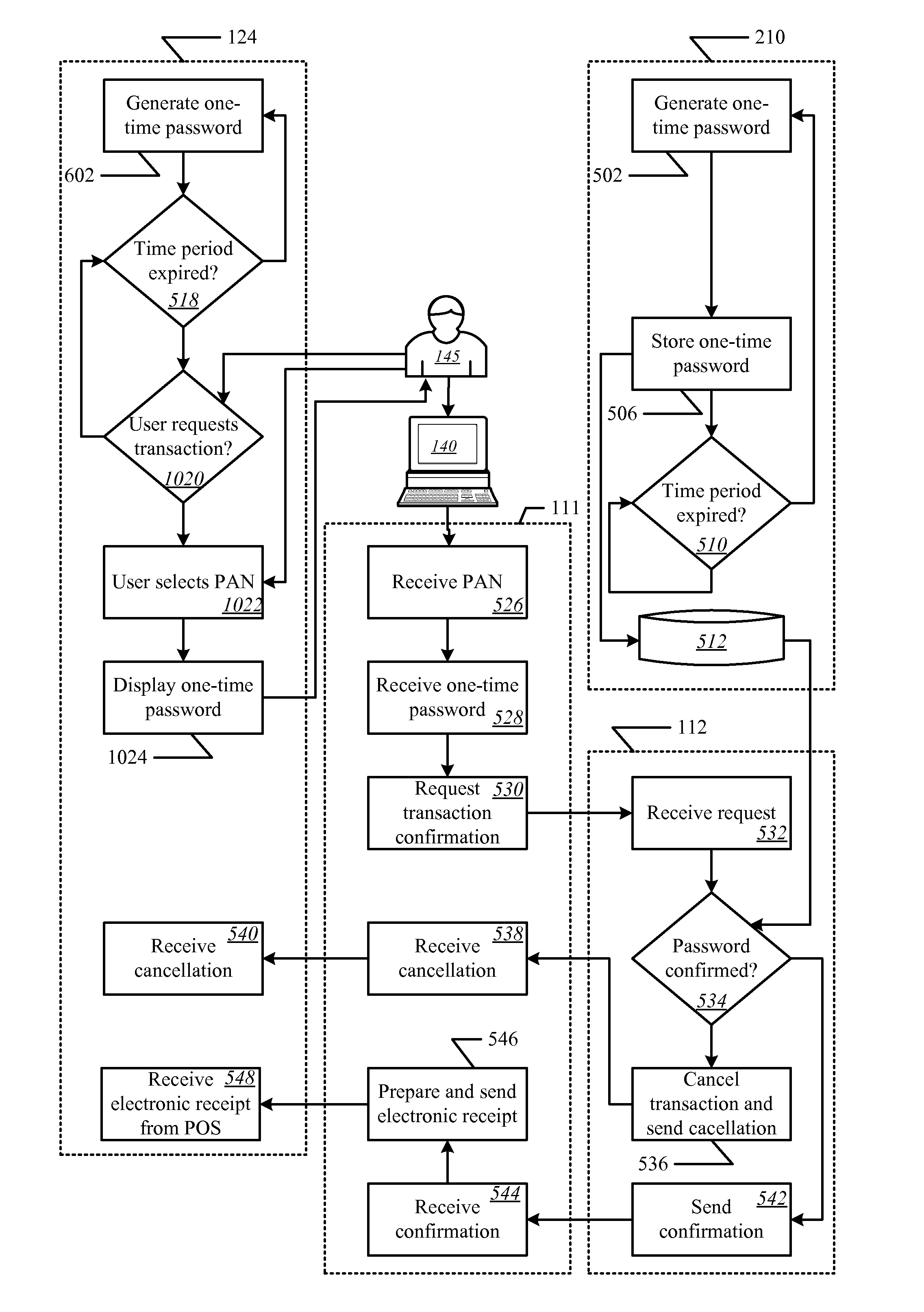

Onetime passwords for smart chip cards

ActiveUS8095113B2Unauthorised/fraudulent call preventionEavesdropping prevention circuitsDisplay deviceFinancial transaction

A financial transaction card is provided according to various embodiments described herein. The financial transaction card includes a card body with at least a front surface and a back surface. The financial transaction card may also include a near field communications transponder and / or a magnetic stripe, as well as a digital display configured to display alphanumeric characters on the front surface of the card body. The financial transaction card may also include a processor that is communicatively coupled with the near field communications transponder or magnetic stripe and the digital display. The processor may be configured to calculate one-time passwords and communicate the one-time passwords to both the near filed communications transponder or magnetic stripe and the digital display.

Owner:FIRST DATA

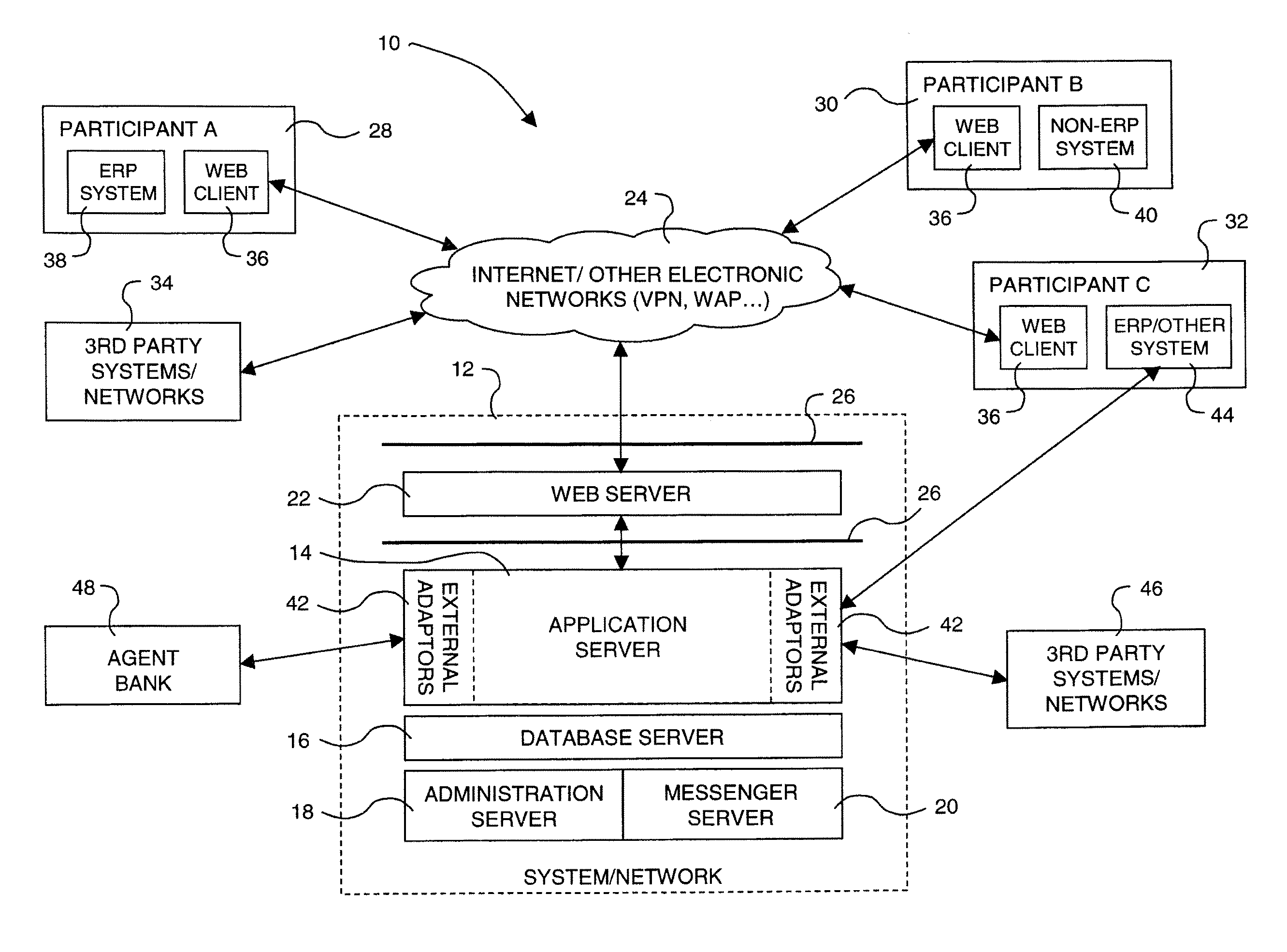

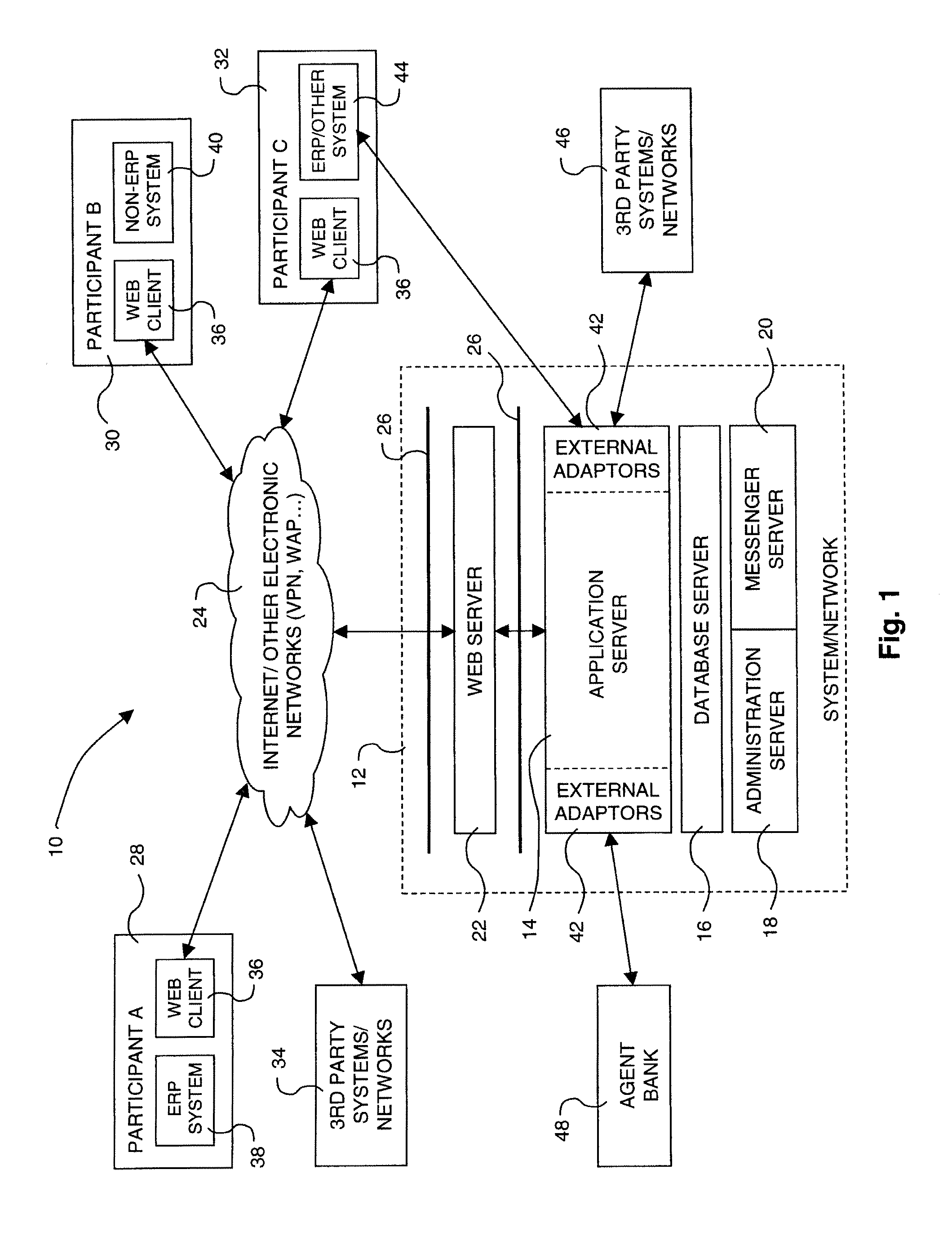

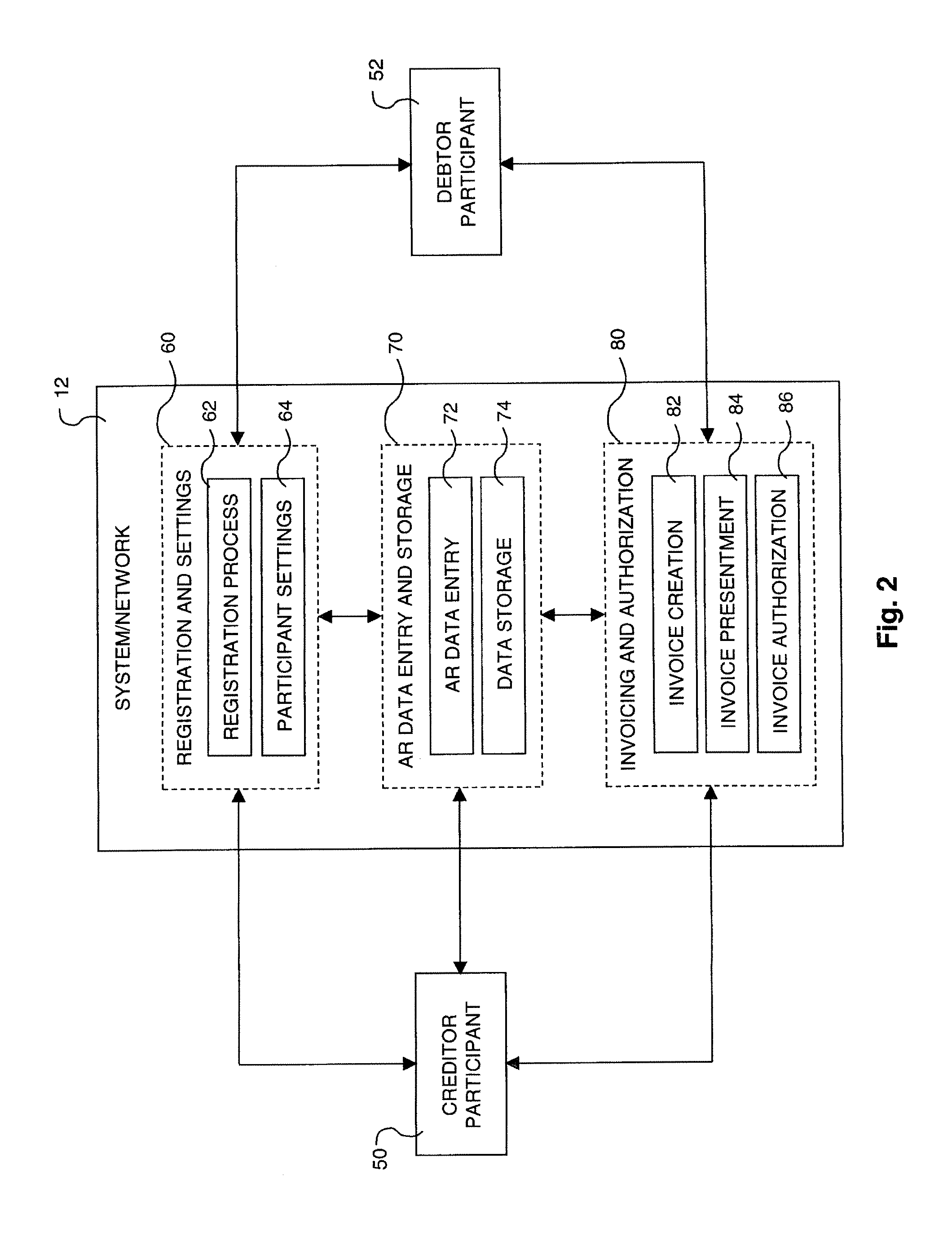

Electronic multiparty accounts receivable and accounts payable system

InactiveUS7206768B1Facilitating collection and trackingFacilitate communicationComplete banking machinesFinanceAccounts payableInvoice

The invention concerns a multiparty accounts receivable and accounts payable system that allows business trading partners to use a single, shared system for both accounts receivable and accounts payable management. The system of the invention forms an electronic “bridge” between a plurality of business trading partners for purposes of invoicing, dispute resolution, financing, and settlement of single and multiple currency debts. As the invoicing and settlement activities of the participants are funneled through a common system, the system allows a participant to aggregate all debts owed to other participants, aggregate all debts owed by the other participants, and net debts owed to other participants with debts owed by these participants. After aggregation and netting, the participant issues a single payment to settle numerous accounts payable items, and receives a single payment that settles numerous accounts receivable items. The system allows participants to use the substantial amount of financial and cash flow information captured by the system to borrow more efficiently by permitting lenders to view this information. Furthermore, the system provides a confirmation process to convert existing debt obligations into a new, independent payment obligation due on a date certain and free of any defenses to the underlying contract. The confirmed debt obligations provide a better source of working capital for the participants, or can be converted into electronic promissory notes. The system provides an electronic exchange for electronic promissory notes, allowing participants to raise working capital in various ways, for example, by selling them.

Owner:JPMORGAN CHASE BANK NA +1

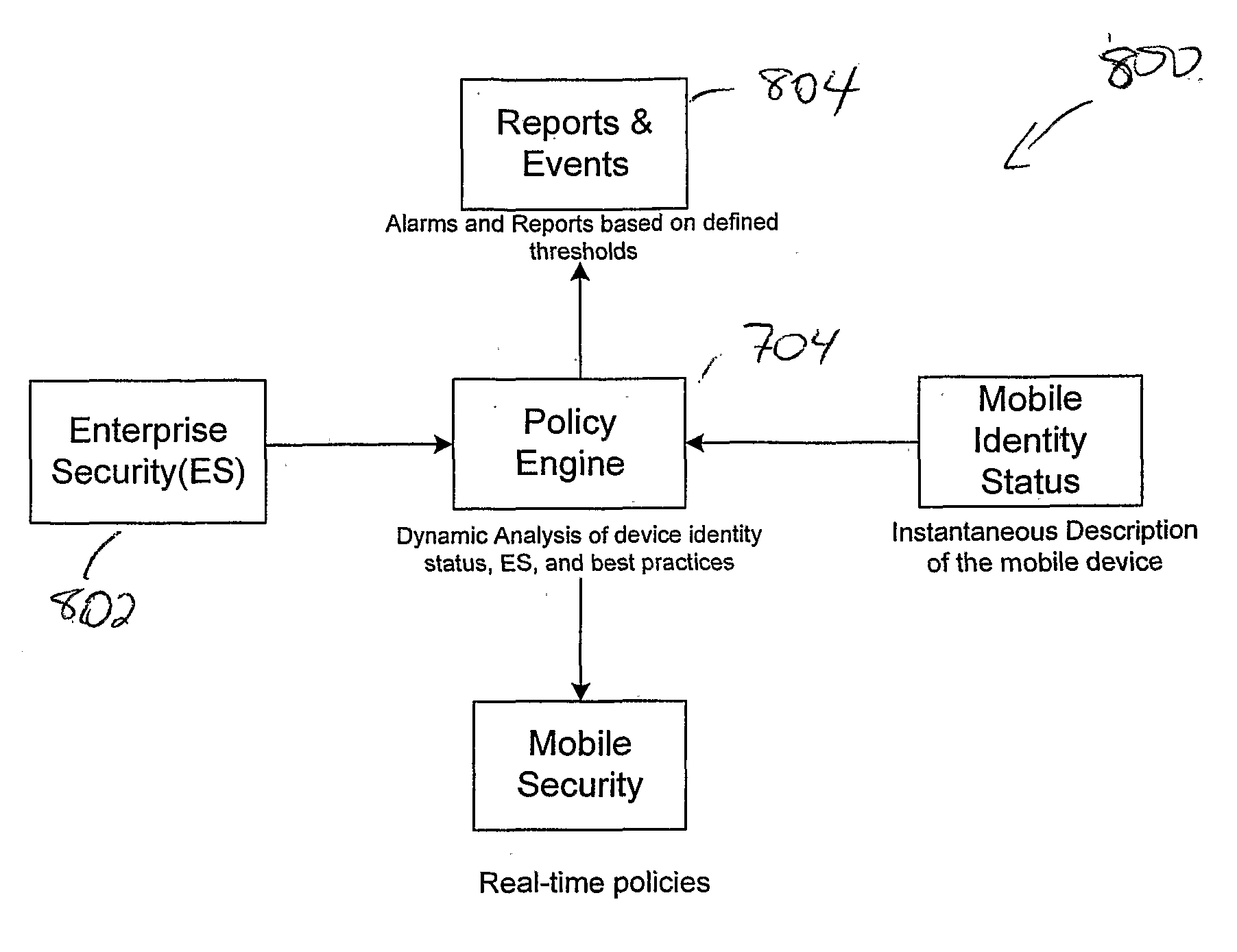

System and method for enforcing a security policy on mobile devices using dynamically generated security profiles

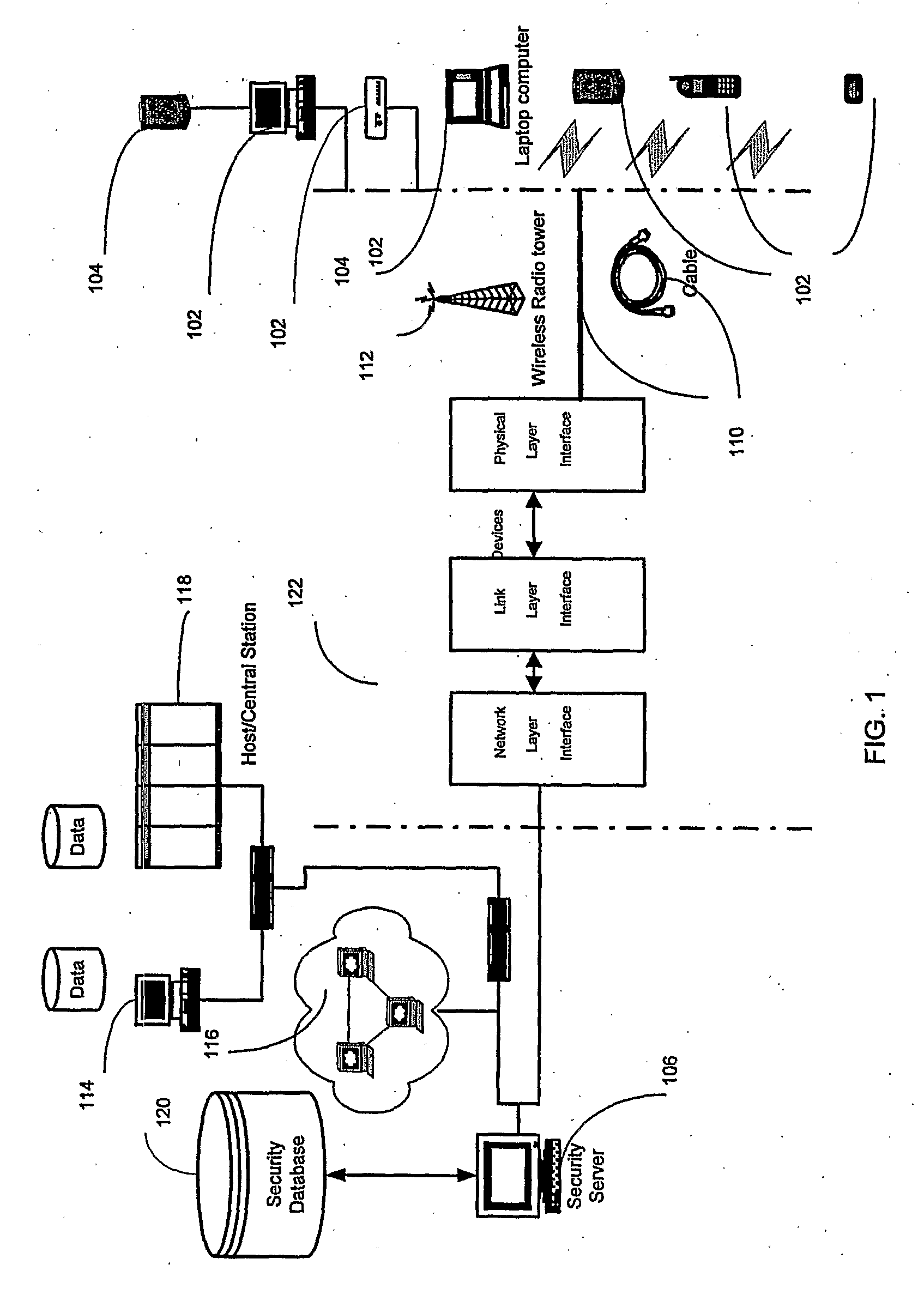

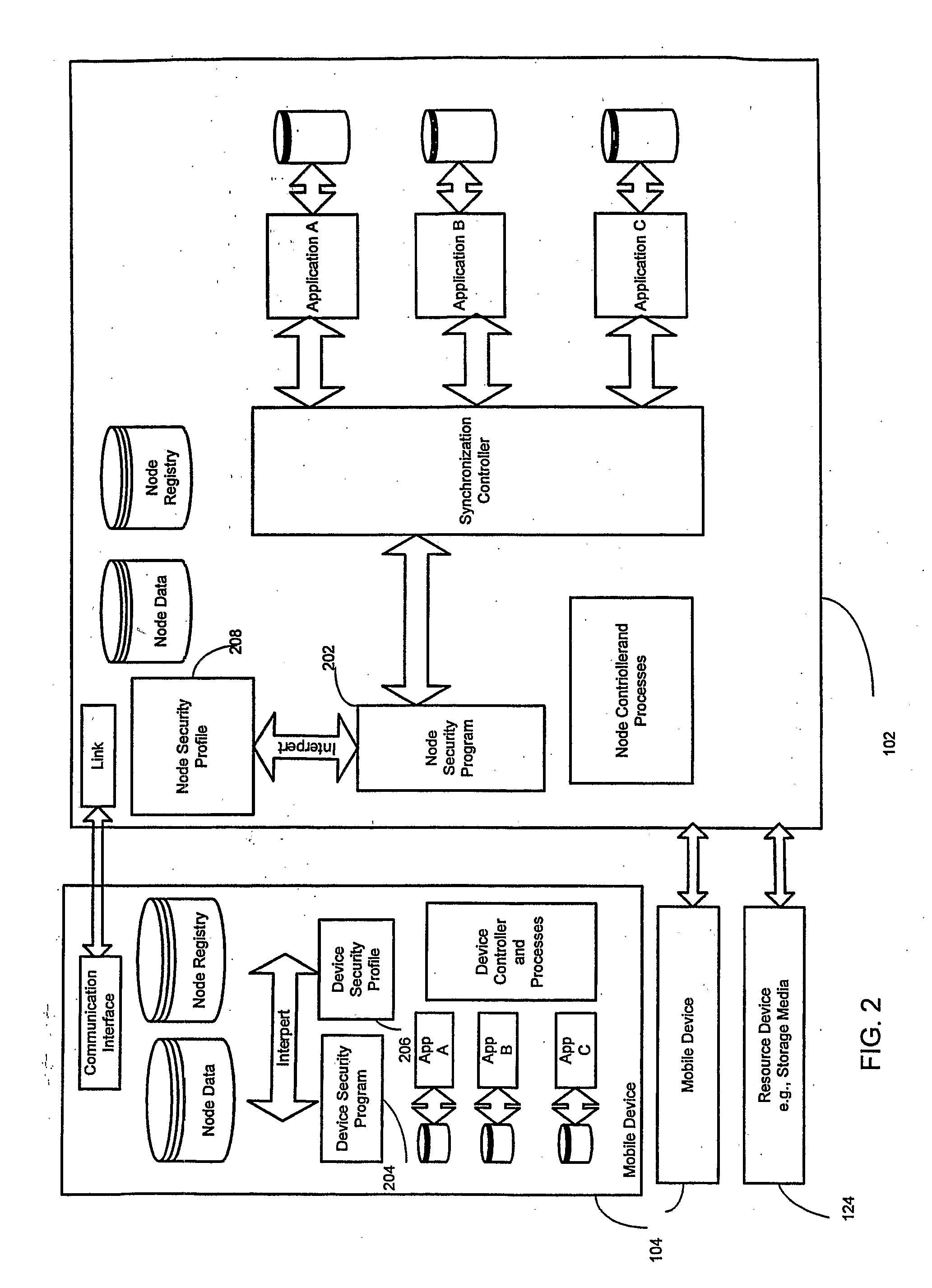

ActiveUS20070143824A1Eliminate needComplete banking machinesPayment architectureComputer networkSecurity parameter

A system and method for enforcing security parameters that collects information from a source relating to a mobile device (104). Based on the collected information, an identity status for the mobile device (104) is determined that uniquely identifies the mobile device (104) and distinguishes it from other mobile devices. The identity status of the mobile device (104) can be determined when the mobile device (104) connects to a computing node source (102) or when the mobile device (104) accesses a resource (124) within the network. A security profile based on the identity status of the mobile device (104) is generated and the security profile is applied to the mobile device (104).

Owner:TRUST DIGITAL

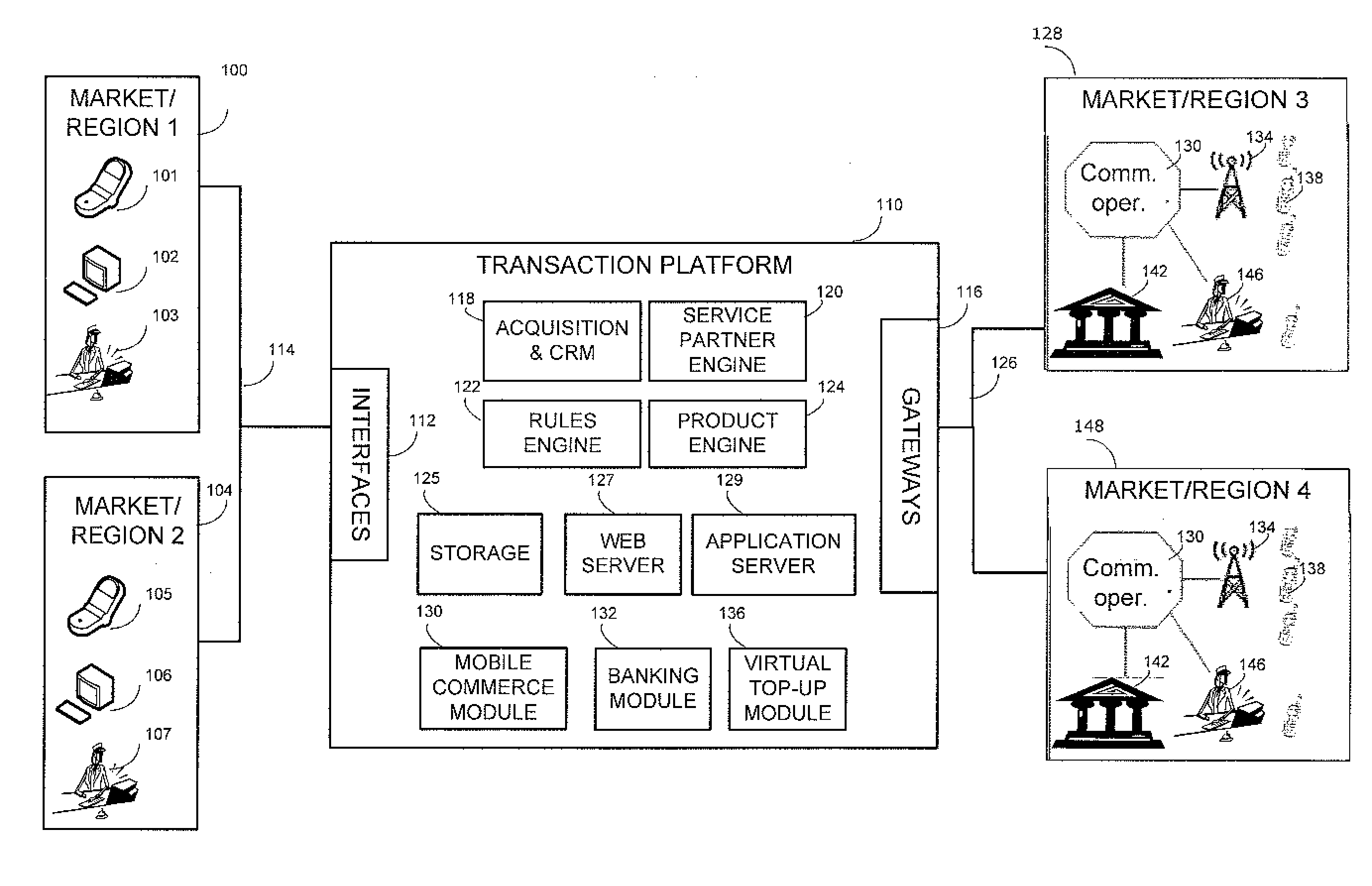

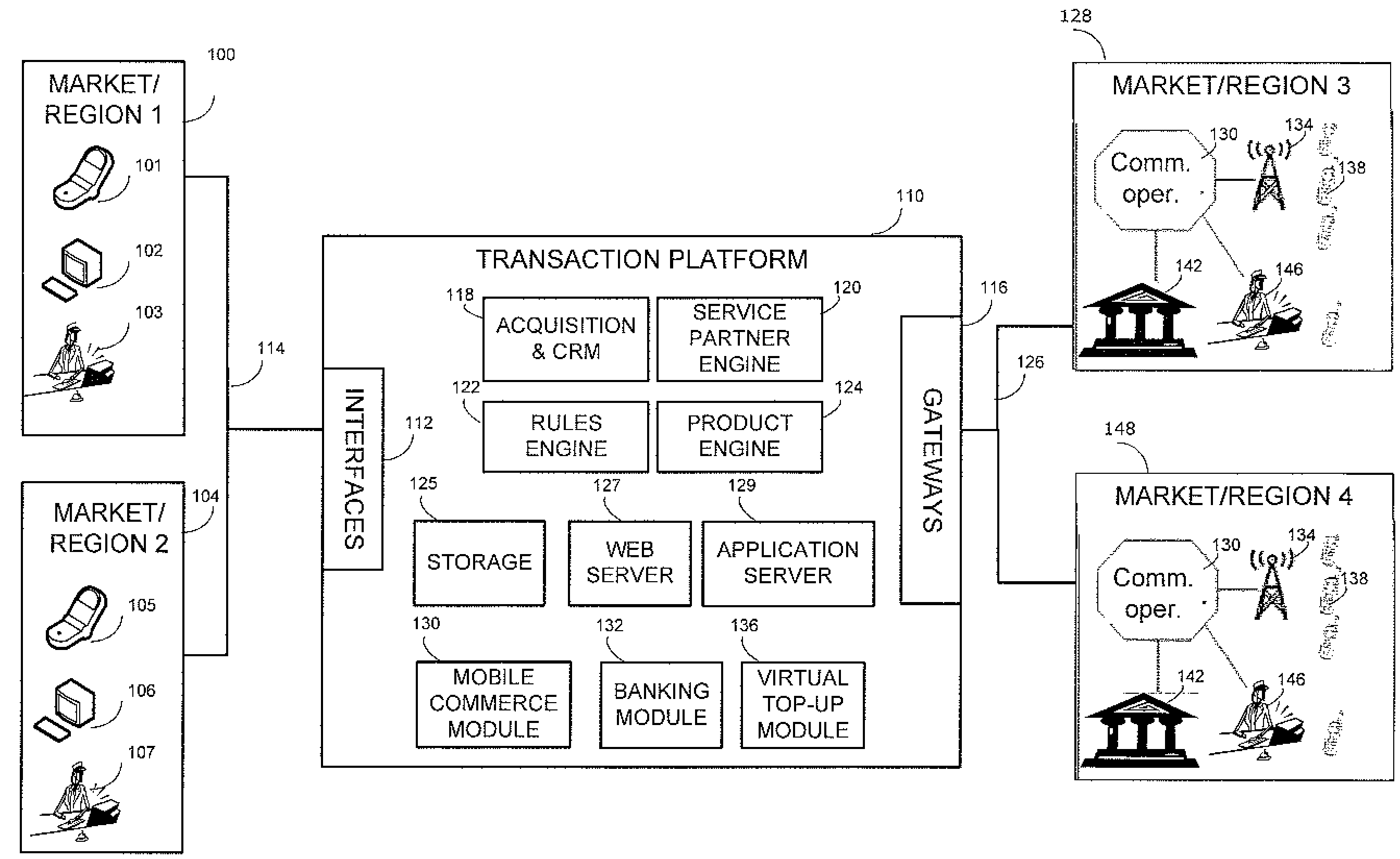

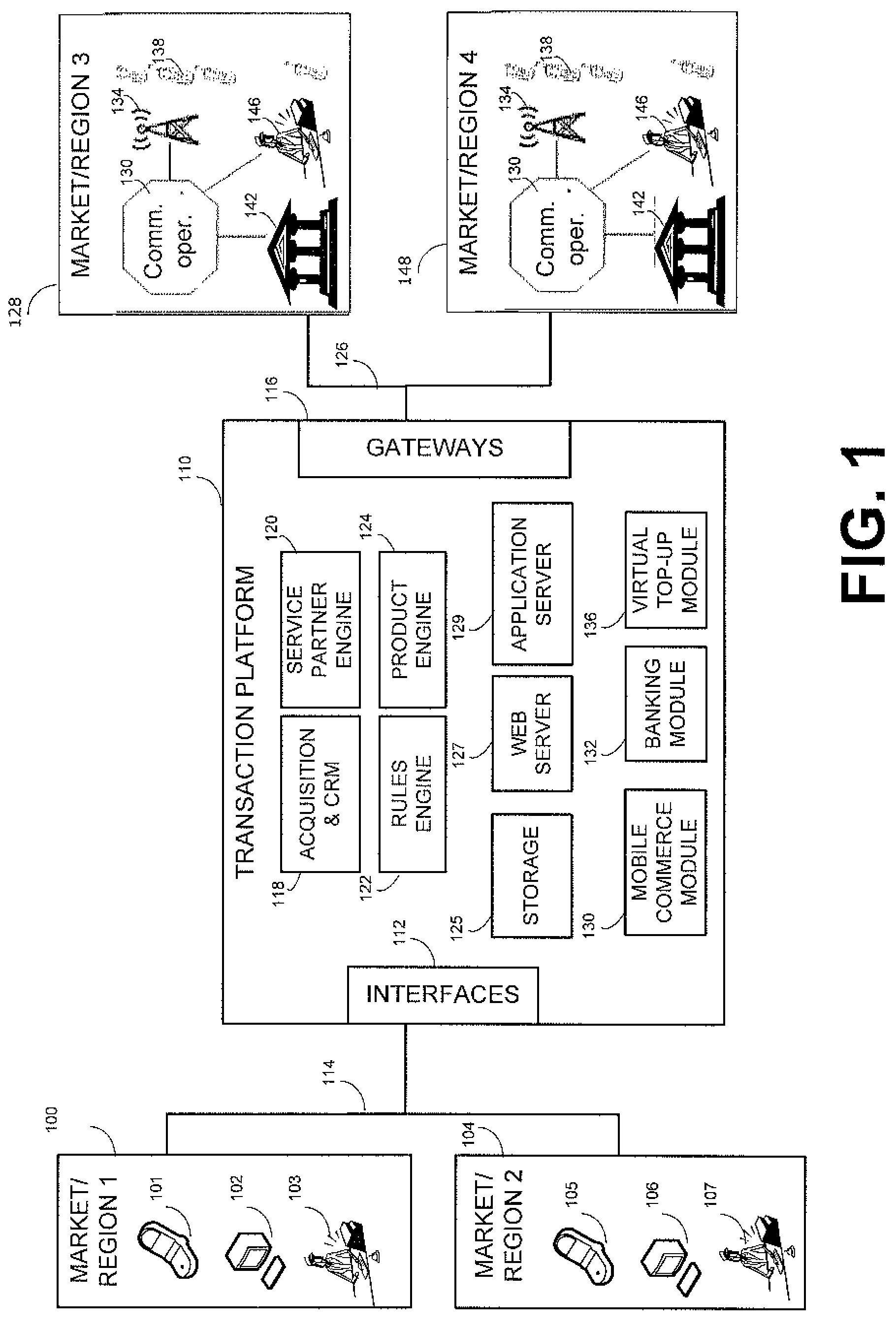

Apparatus and method for facilitating money or value transfer

An apparatus and method for transferring money or value, using a wide range of interfaces to initiate a transfer and a wide range of options for receiving the transfer, including receiving the transferred sum directly to the communication device / account of the receiver. The receiver can use the transferred sum as an airtime credit, to obtain cash or to pay for other goods or services.

Owner:HIP CONSULT

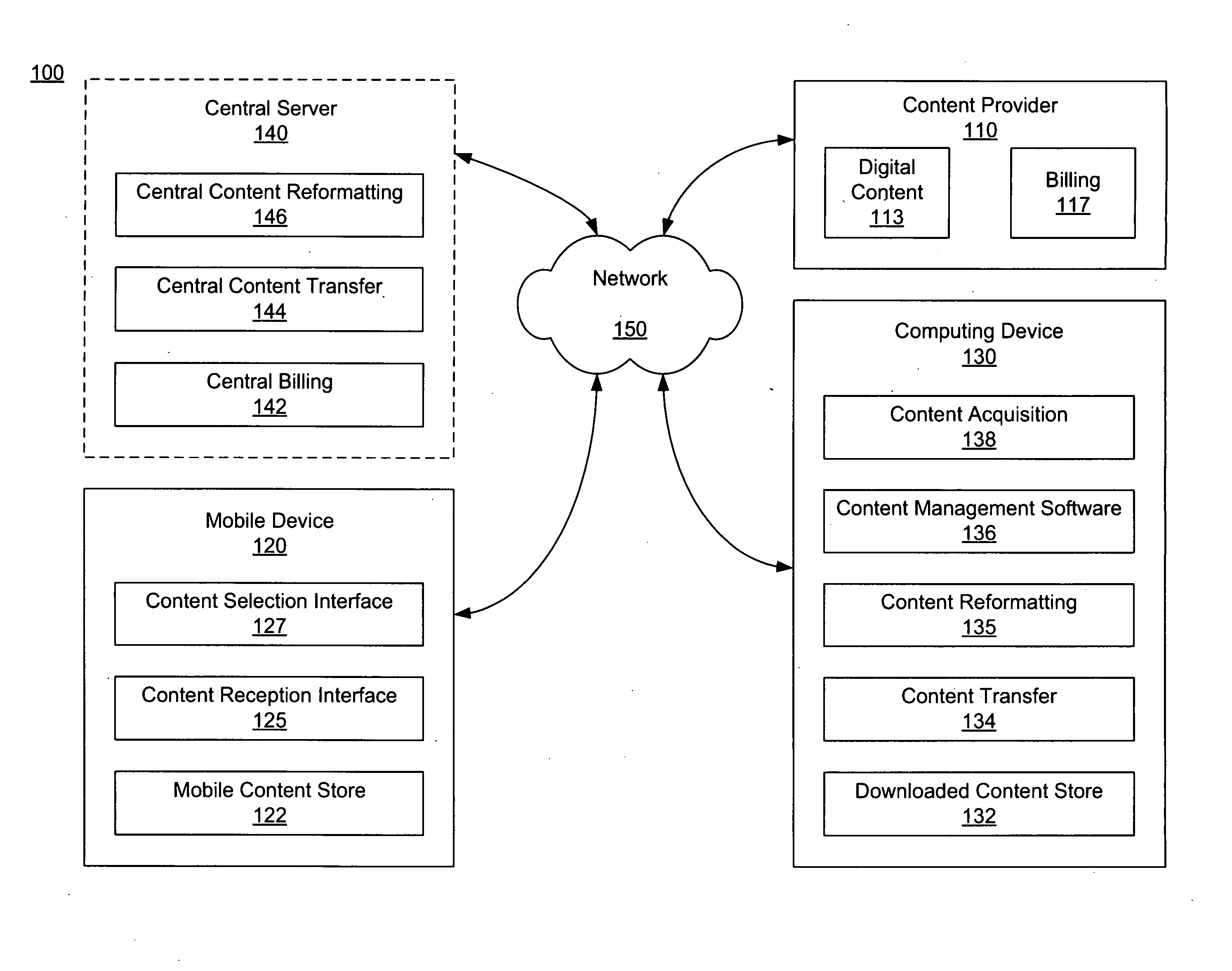

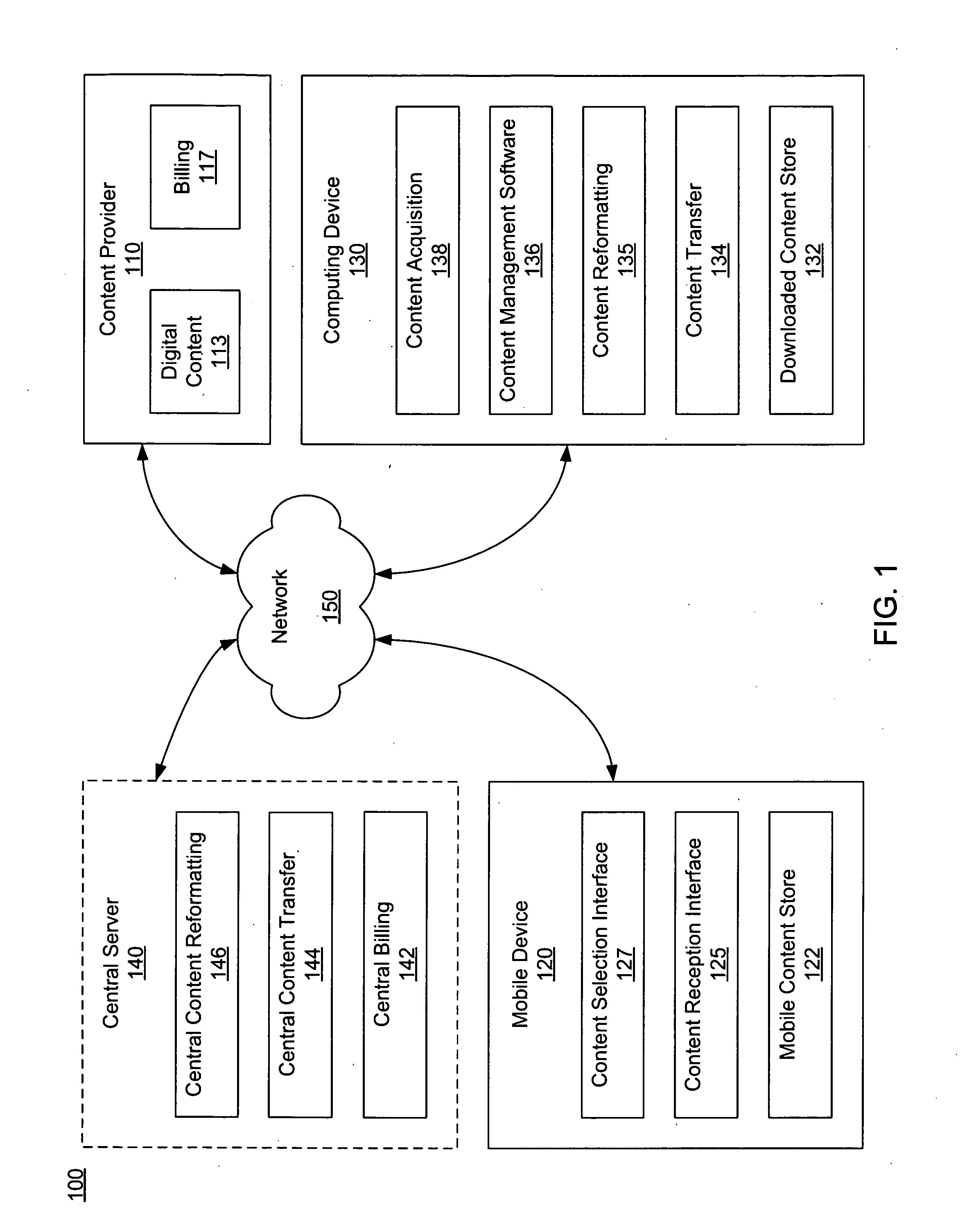

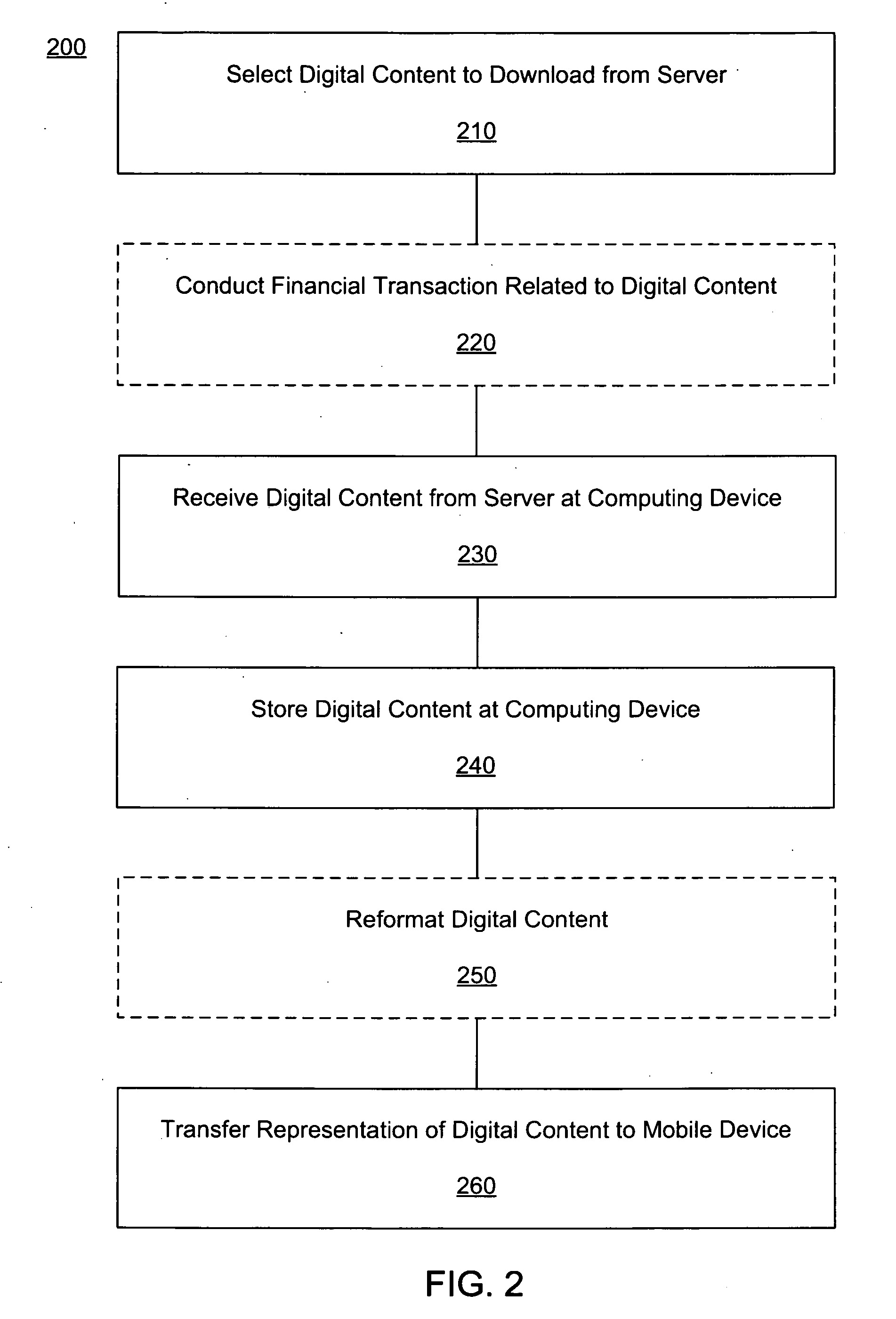

Content delivery to a mobile device from a content service

InactiveUS20090157792A1Reduce rateReduce resolutionComplete banking machinesTelephonic communicationService provisionDigital content

Systems and methods for delivering digital content to a mobile device from a digital content provider are disclosed. Digital content is selected using a selection interface on the mobile device. The selected content is then transferred to a computing device by the digital content provider and subsequently transferred to the mobile device by the computing device. In some embodiments, the digital content is reformatted before being transferred to the mobile device. The digital content may be streamed from the computer system to the mobile device. A service provider of a network through which the mobile device connects to the digital content provider may bill a user of the mobile device on behalf of the digital content provider. The digital content provider may bill the user of the mobile device using a Premium SMS service.

Owner:SEVEN NETWORKS INC

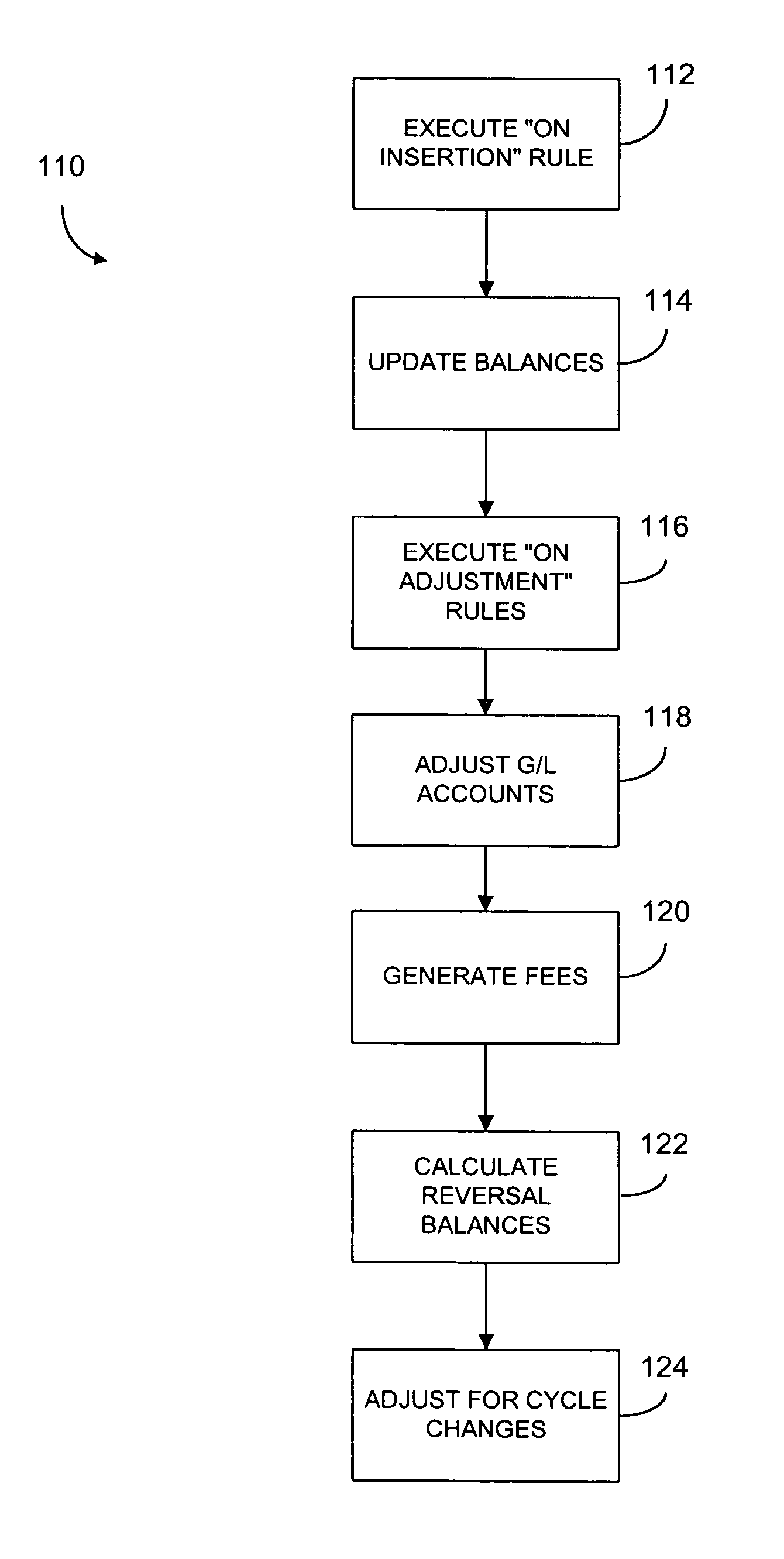

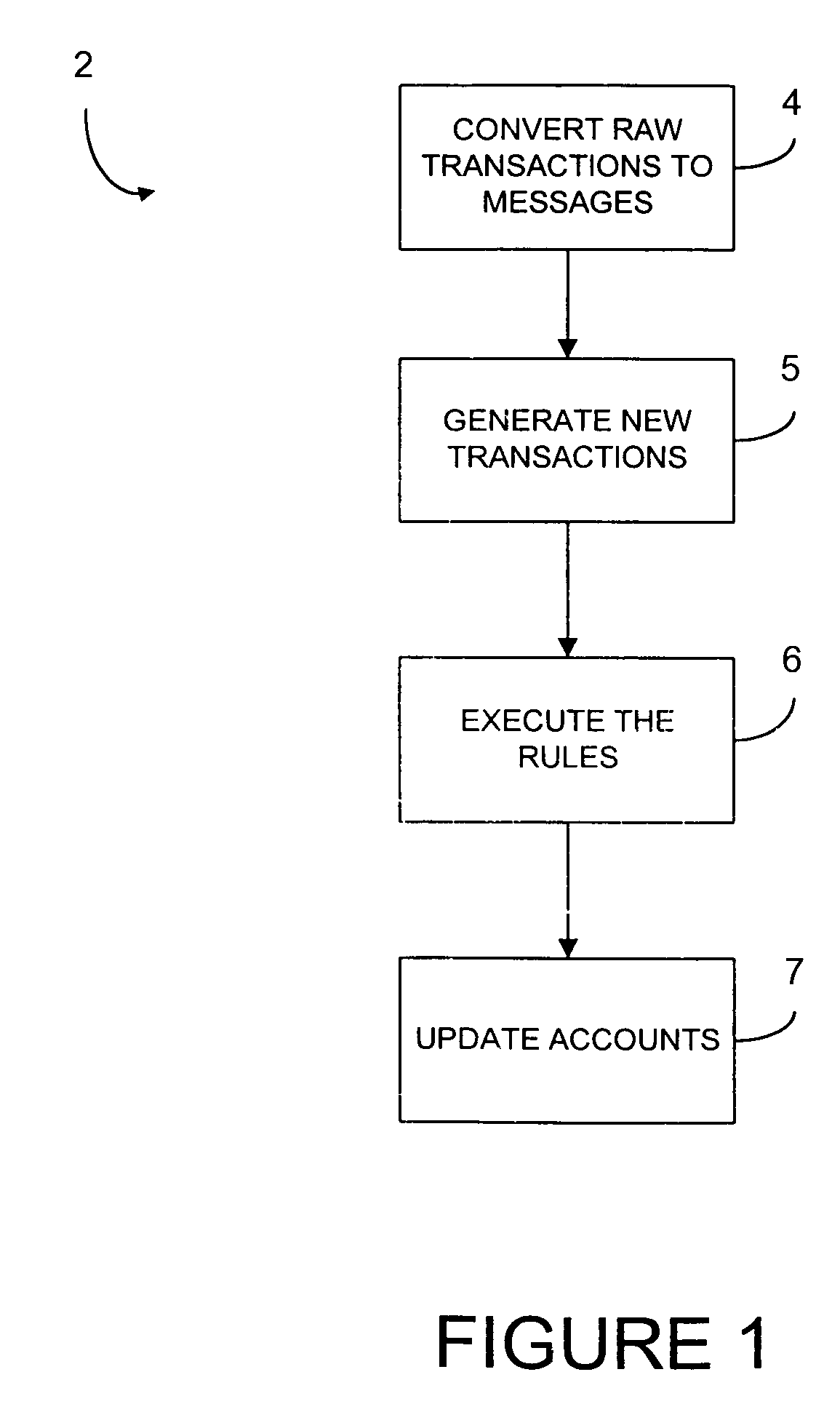

Methods and systems for managing financial accounts

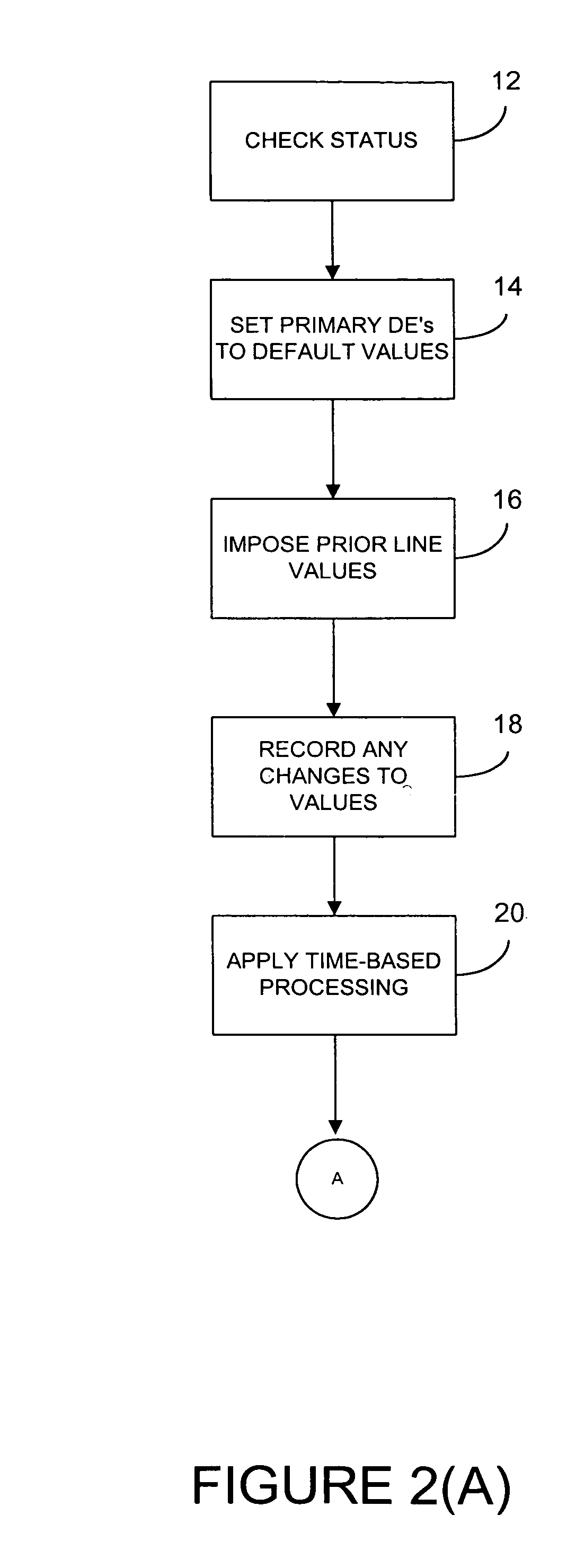

InactiveUS7117172B1Useful managingReduce in quantityComplete banking machinesFinanceSource codeParameter control

Processing systems and methods receive events, such as a transaction to an account, and converts the events into messages. Each message then invokes one or more rules which are executed by a rules engine. The execution of these rules may invoke the execution of additional rules. After all rules have executed, the account associated with the event is updated, such as by projecting the account. The rules have their parameters defined in a repository so that the parameters can be easily changed without any need to recompile. The processing systems receive authorizations and other transactions and runs in real-time as transactions arrive. As a result, balances are updated continuously and accounts are read and updated only when there is activity. Hierarchy is user configurable, including multiple hierarchy to any depth. System operations are controlled by rules and their parameters and most modifications can be accomplished without access to source code.

Owner:CORECARD SOFTWARE

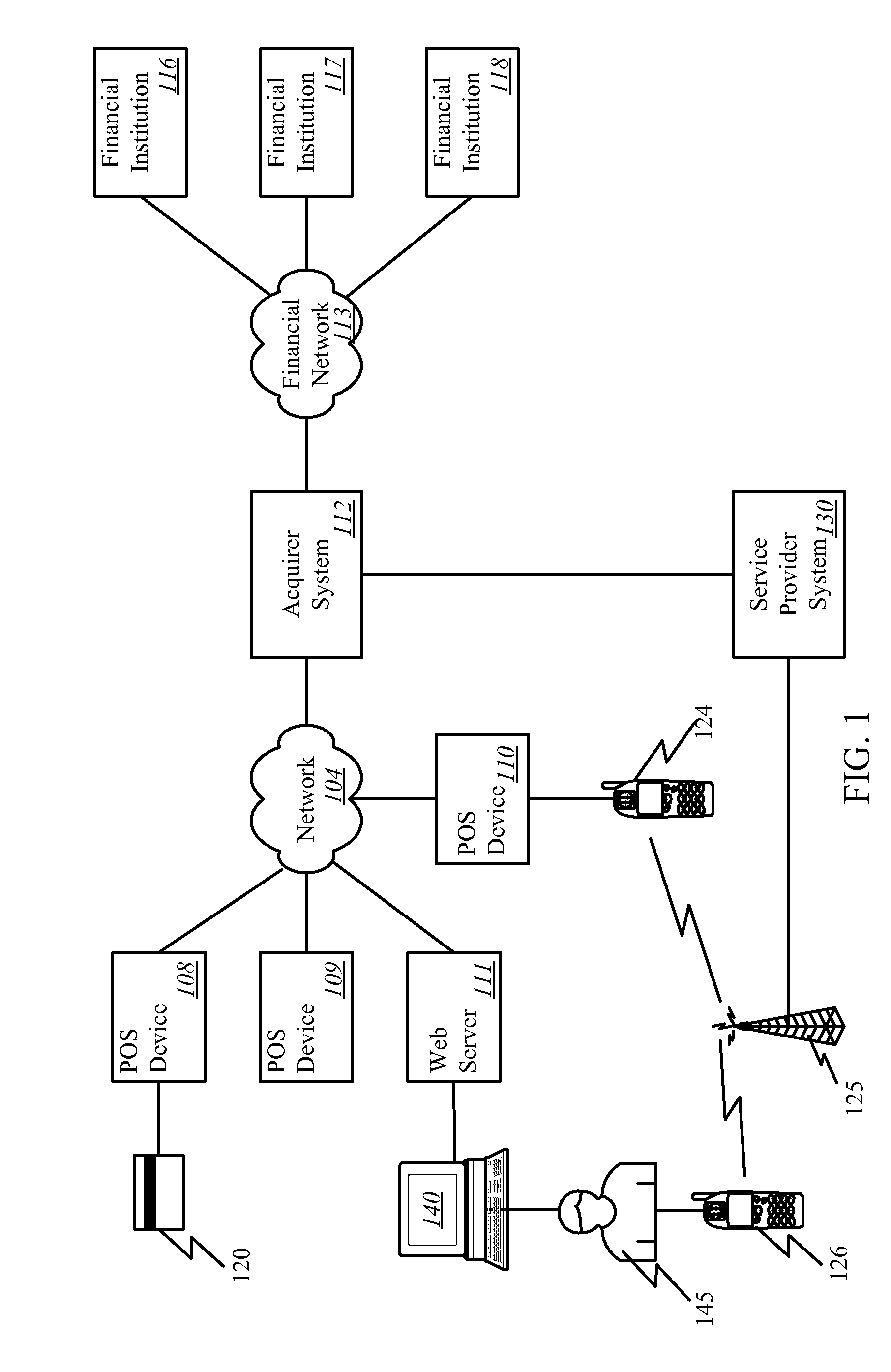

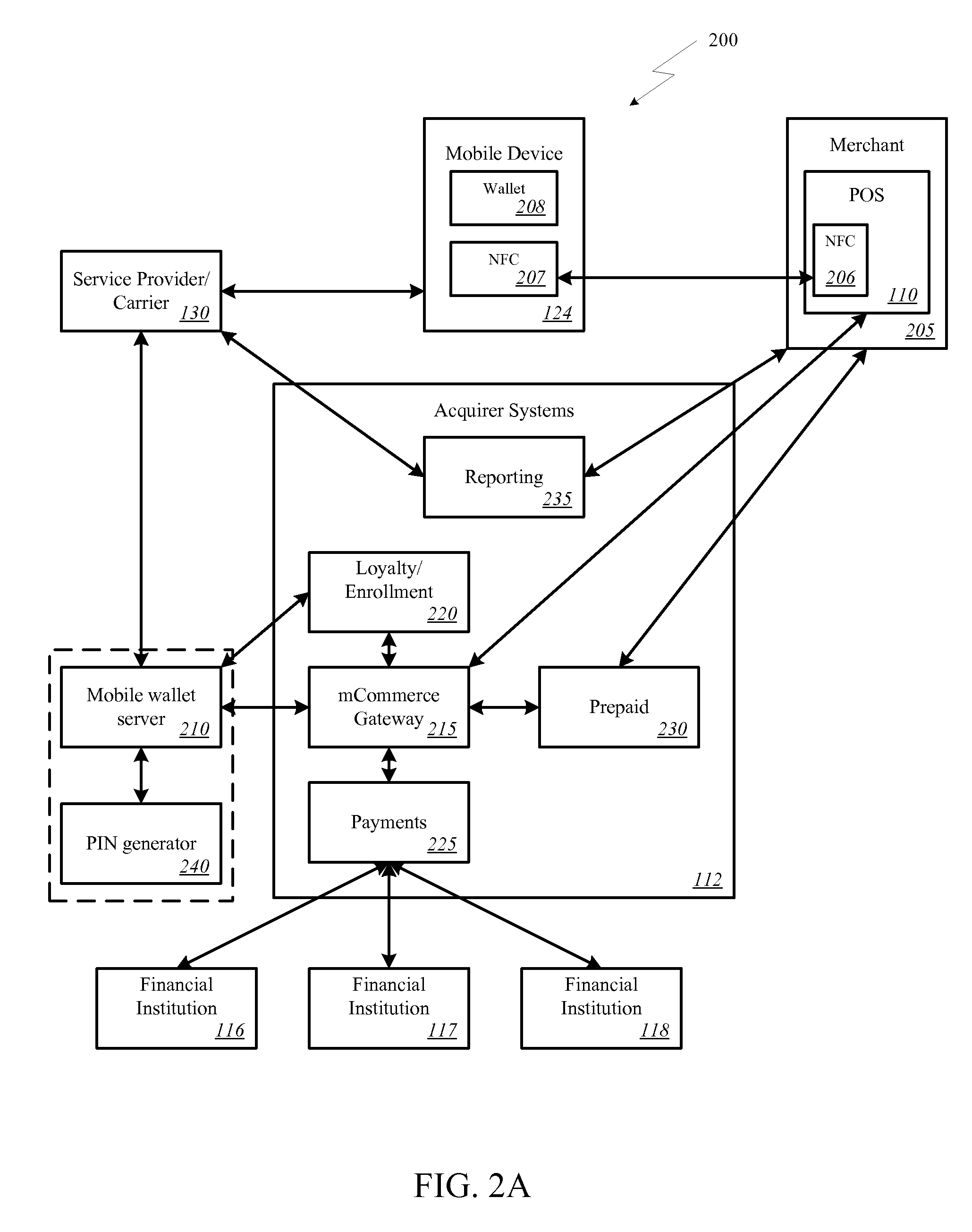

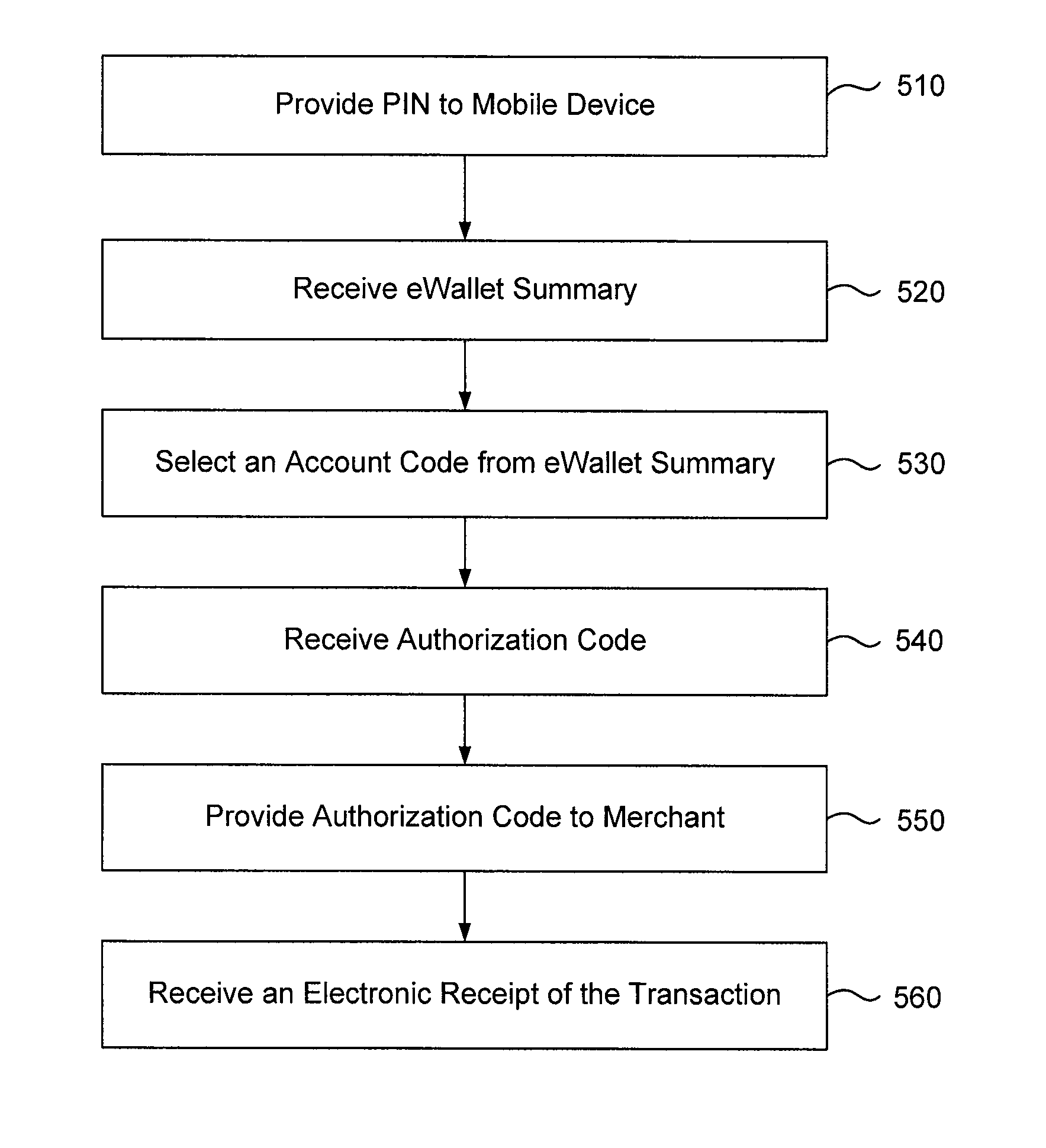

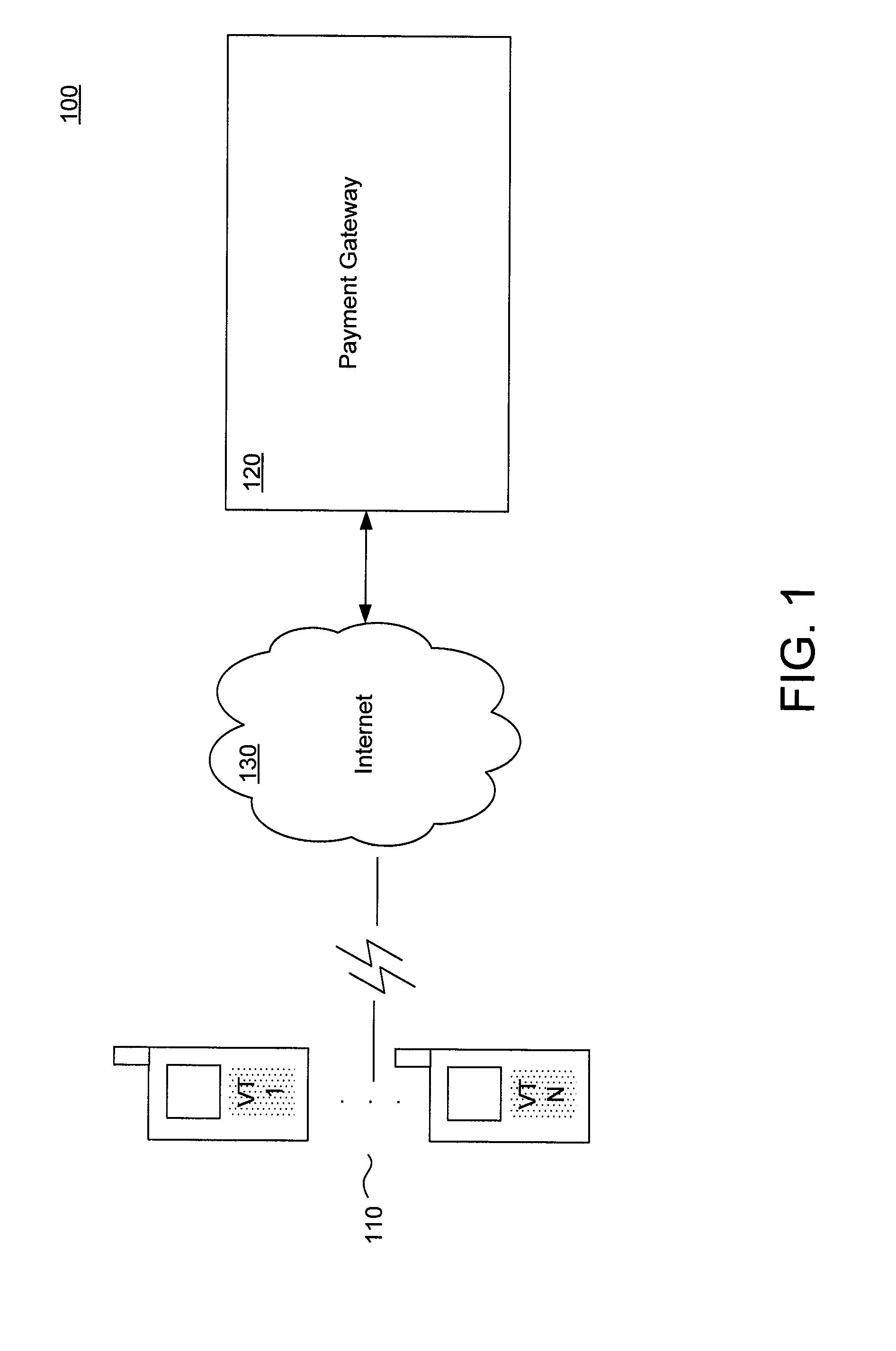

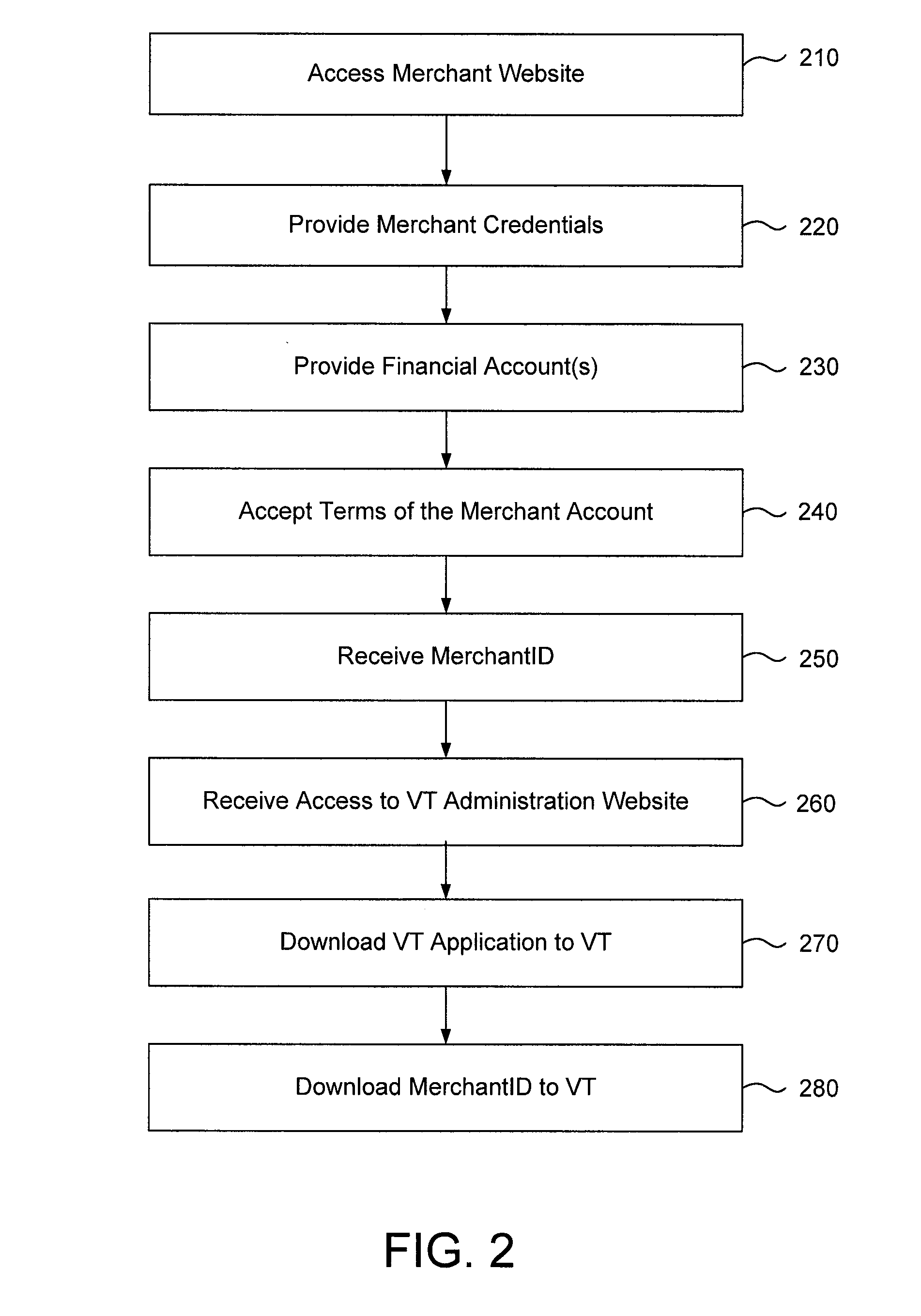

Method and System for Processing Secure Wireless Payment Transactions and for Providing a Virtual Terminal for Merchant Processing of Such Transactions

A system and method for processing a wireless electronic payment transaction is described. One embodiment comprises receiving a transaction authorization request for an electronic payment transaction from a customer, the authorization request submitted from a mobile communication device of the customer; authenticating the transaction authorization request; authorizing the transaction authorization request and transmitting an authorization code to the mobile communication device, the authorization code being communicated to a merchant from the customer; receiving a transaction approval request from the merchant, the transaction approval request submitted from a virtual terminal associated with the merchant, the virtual terminal being a wireless communication device having a point of sale processing application installed therein; authenticating the transaction approval request; approving the transaction approval request and transmitting an approval code to the virtual terminal; and generating and executing transaction settlement instructions between a financial account of the customer and a financial account of the merchant.

Owner:MOCAPAY

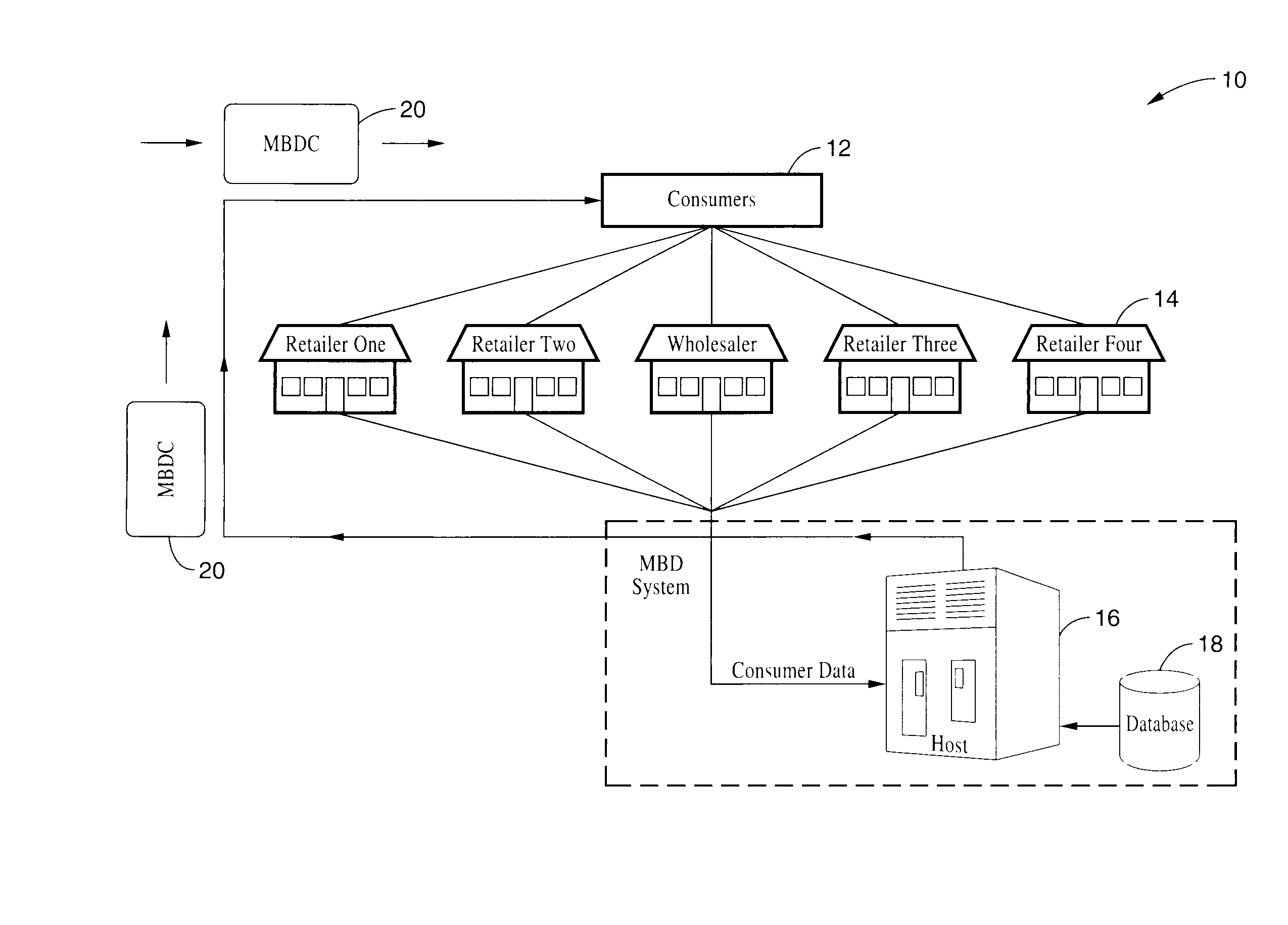

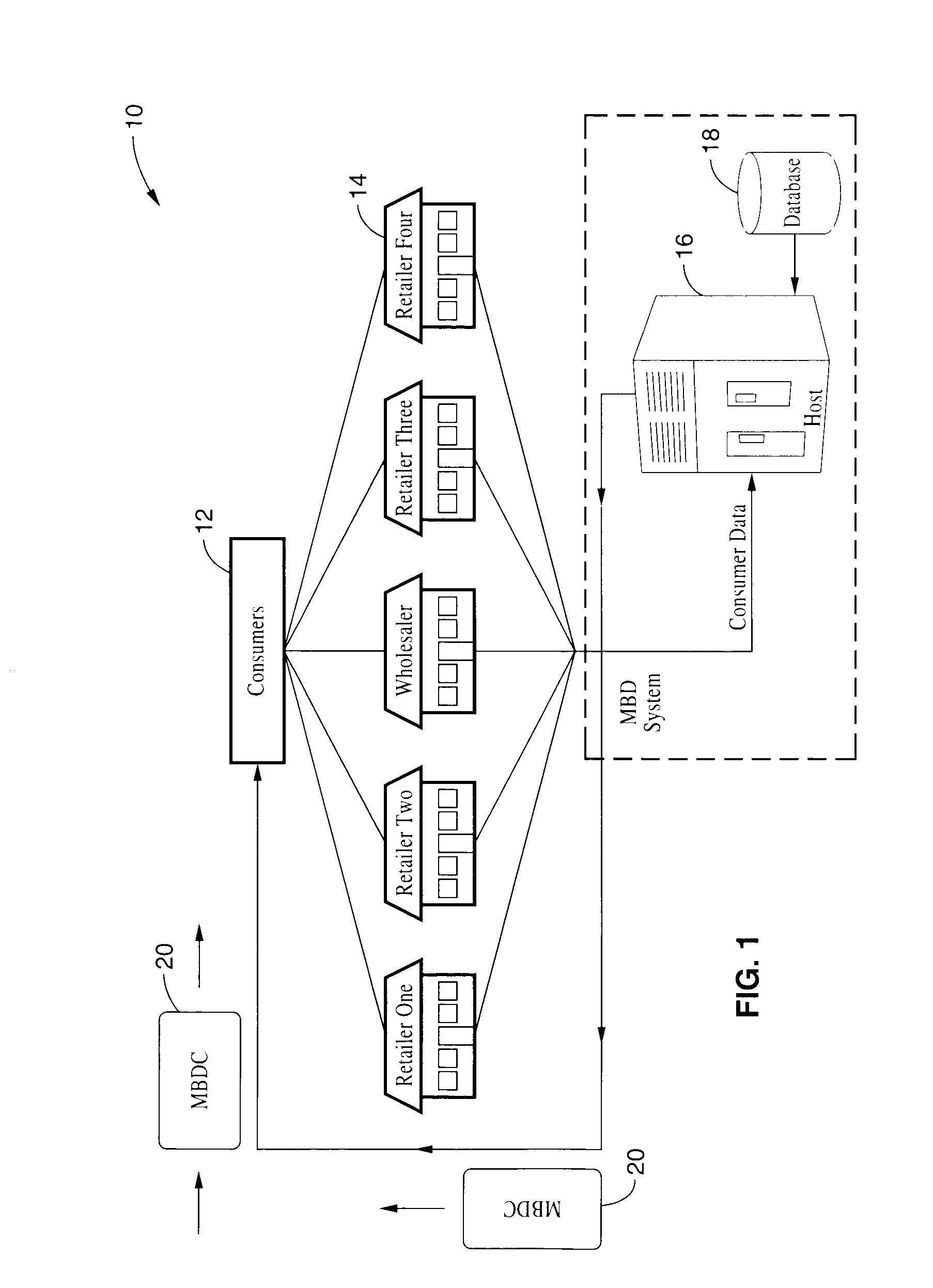

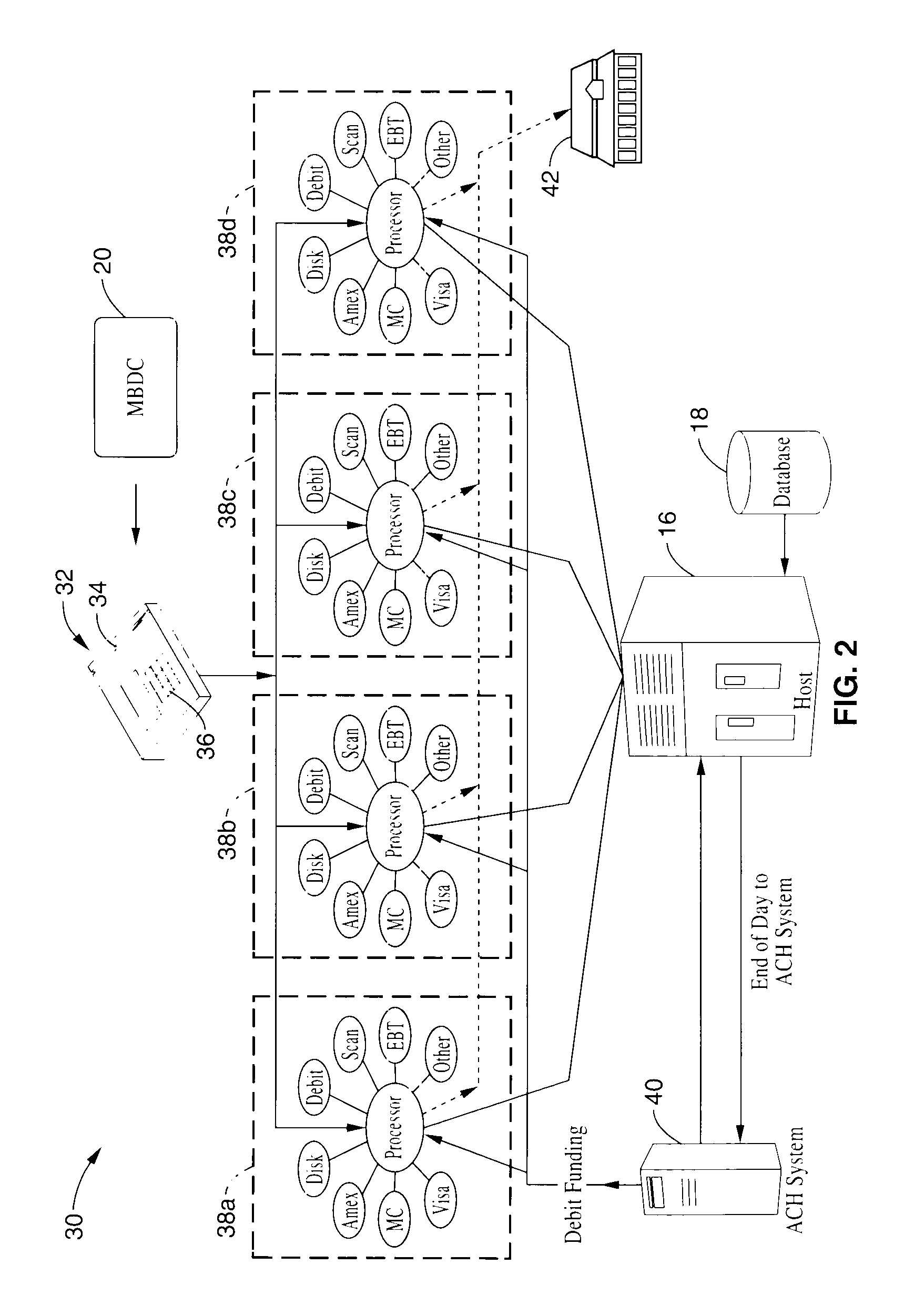

Method and system for facilitating electronic funds transactions

InactiveUS7104443B1Measurement is limitedReduce transaction costsComplete banking machinesFinanceInformation sharingMerchant account

A method and system for executing electronic funds transactions using a merchant based debit (MBD) card in a merchant-centric system that provides for reduced fees to acquiring merchants and remitting a portion of the collected fees to issuing merchants. The system also preferably provides information sharing on consumer transactions with merchants to facilitate consumer based incentive programs and the like. The system operates over conventional card processing infrastructure and utilizes the ACH network, or equivalent, to settle the transaction from a consumer checking account, or a merchant account in the case of a prepaid MBD card. Using the system, merchants may elect to qualify customers based on their own criterion. A portion of the interchange fee is distributed to the issuing merchant associated transaction executed using the merchant based debit card. Embodiments are described for prepaid, fixed value, programmable, and refillable, forms of merchant based debit cards.

Owner:KIOBA PROCESSING LLC

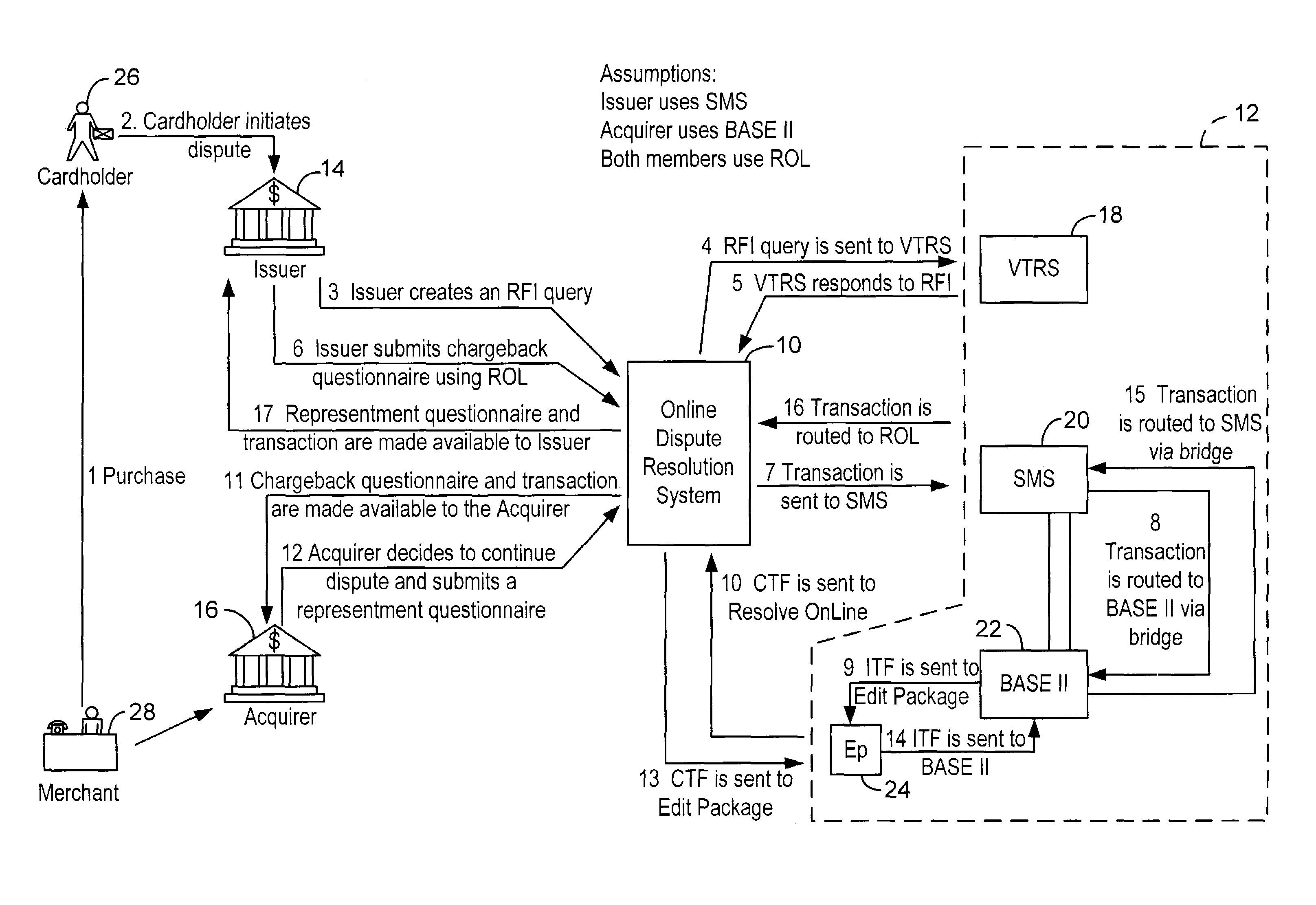

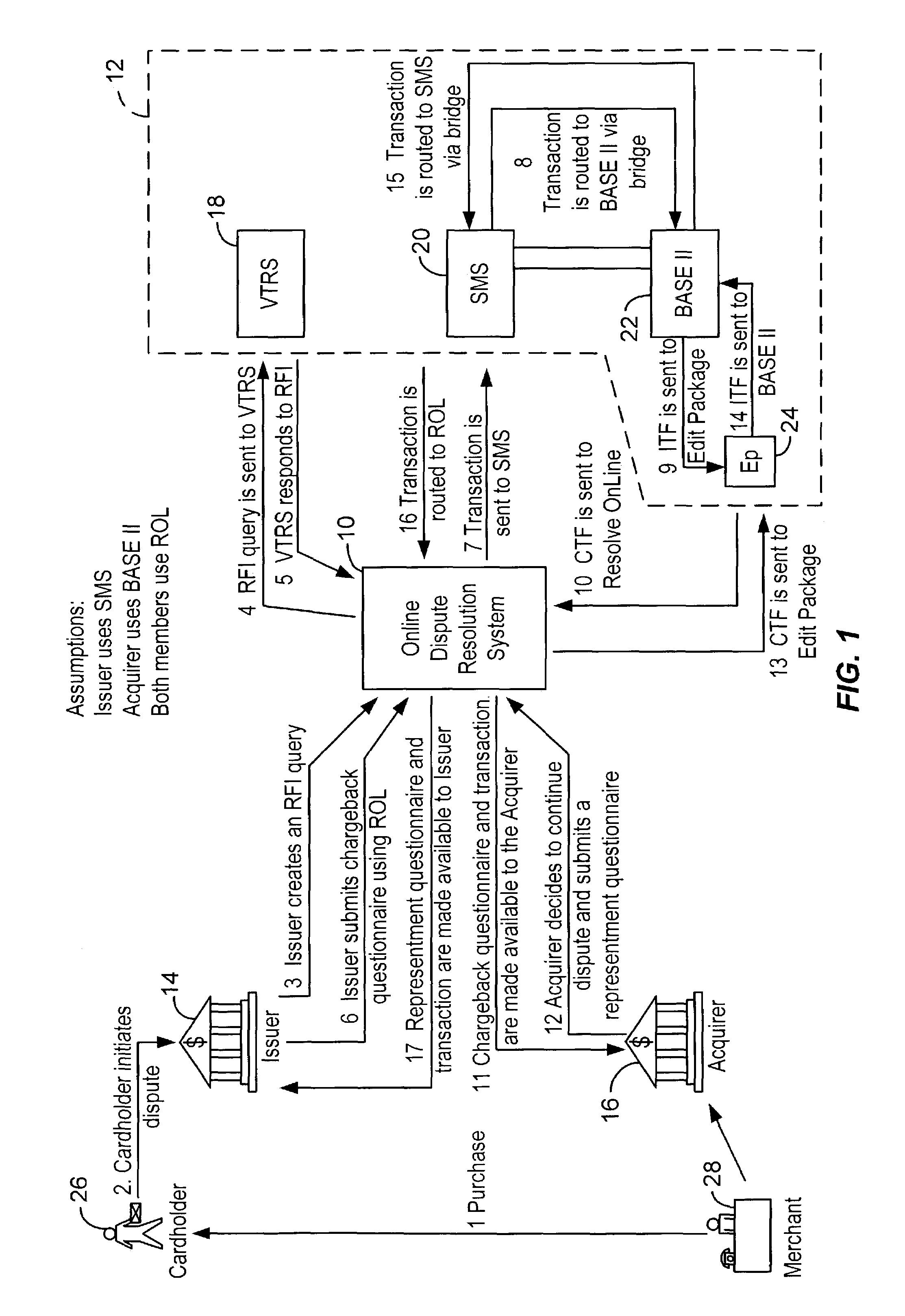

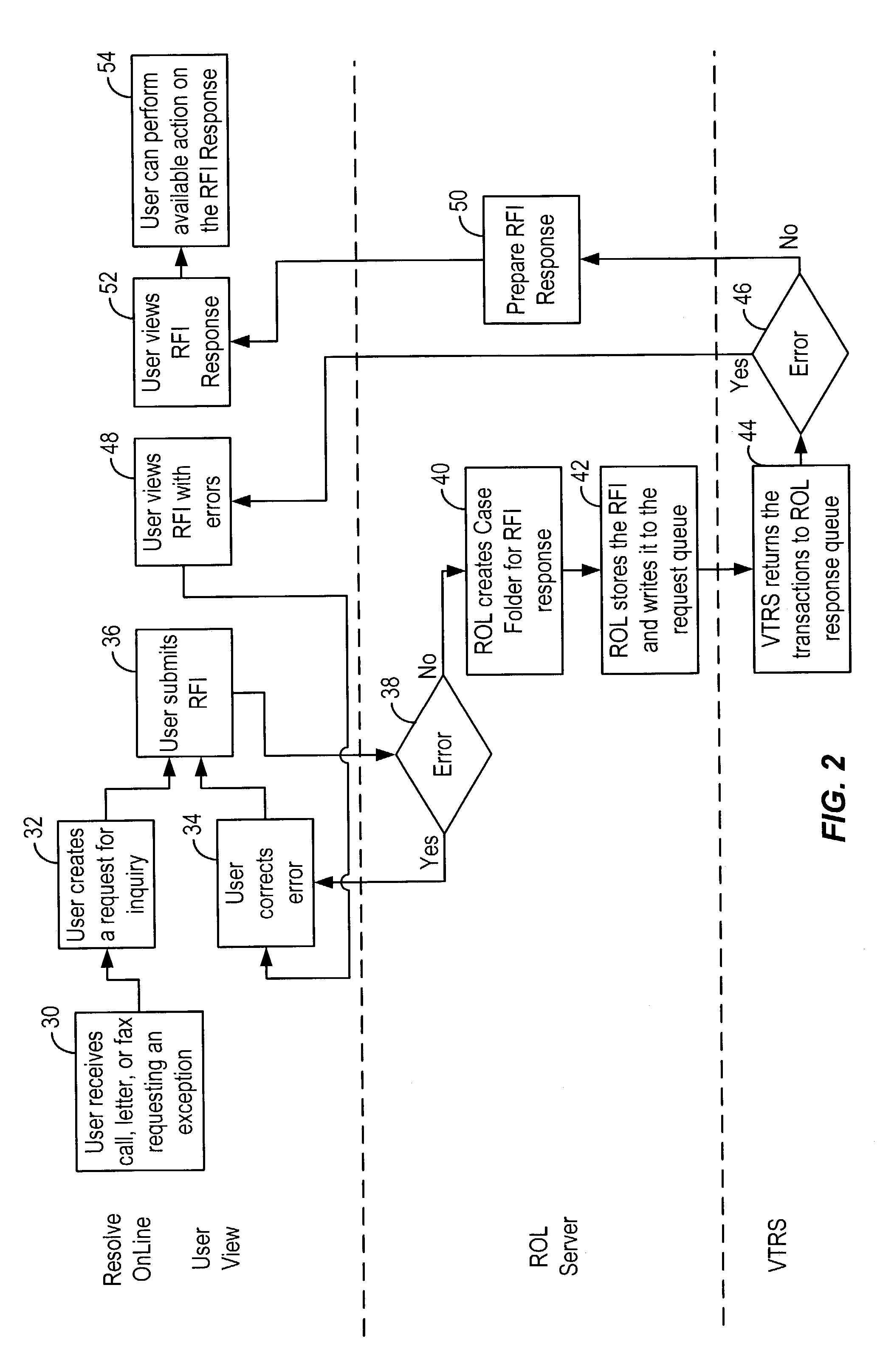

Method and system for facilitating electronic dispute resolution

A system for facilitating payment transaction disputes is provided. According to one aspect of the system, a user, such as an issuer, is allowed to use the system to resolve a disputed transaction. Based on information provided by a cardholder, the issuer is able to use the system to retrieve transactional information relating to the disputed transaction reported by the customer for review. When the issuer uses the system to retrieve information relating to the disputed transaction, a case folder is created. The case folder is a repository for storing all the relevant information and documentation relating to the disputed transaction. Using the information retrieved by the system, the issuer then determines whether to initiate a dispute. Alternatively, the system can also be used by an acquirer to respond to a dispute, usually on behalf of one of its merchant. If a dispute is responded to, a questionnaire is then created by the system. Alternatively, the issuer may decline to initiate a dispute and either seek additional information from the cardholder or deny the cardholder's inquiry. The case folder and the questionnaire are created for a specific disputed transaction. The questionnaire is designed to capture information from the cardholder and / or the issuer relating to the disputed transaction. The questionnaire may be pre-populated with previously retrieved transactional information which is stored in the case folder. Relevant documents in support of the disputed transaction may also be attached as part of the questionnaire. Various parties to the dispute may then provide relevant information (including supporting documentation) to the system. The relevant information provided by the parties is maintained in the case folder. The system then keeps track of the relevant timeframes for the case folder to ensure that each party to the dispute is given the correct period of time to respond during the processing of a dispute. Prior to filing the dispute for arbitration or compliance, the system permits the parties to resolve the dispute amongst themselves without the help of an arbiter through pre-arbitration and pre-compliance. If the parties to the dispute are unable to resolve the dispute on their own, the system also permits the parties to resolve the dispute via arbitration or compliance with the help of an arbiter. The system provides the arbiter with access to the case folder to allow the arbiter to render an informed decision on the dispute.

Owner:VISA USA INC (US)

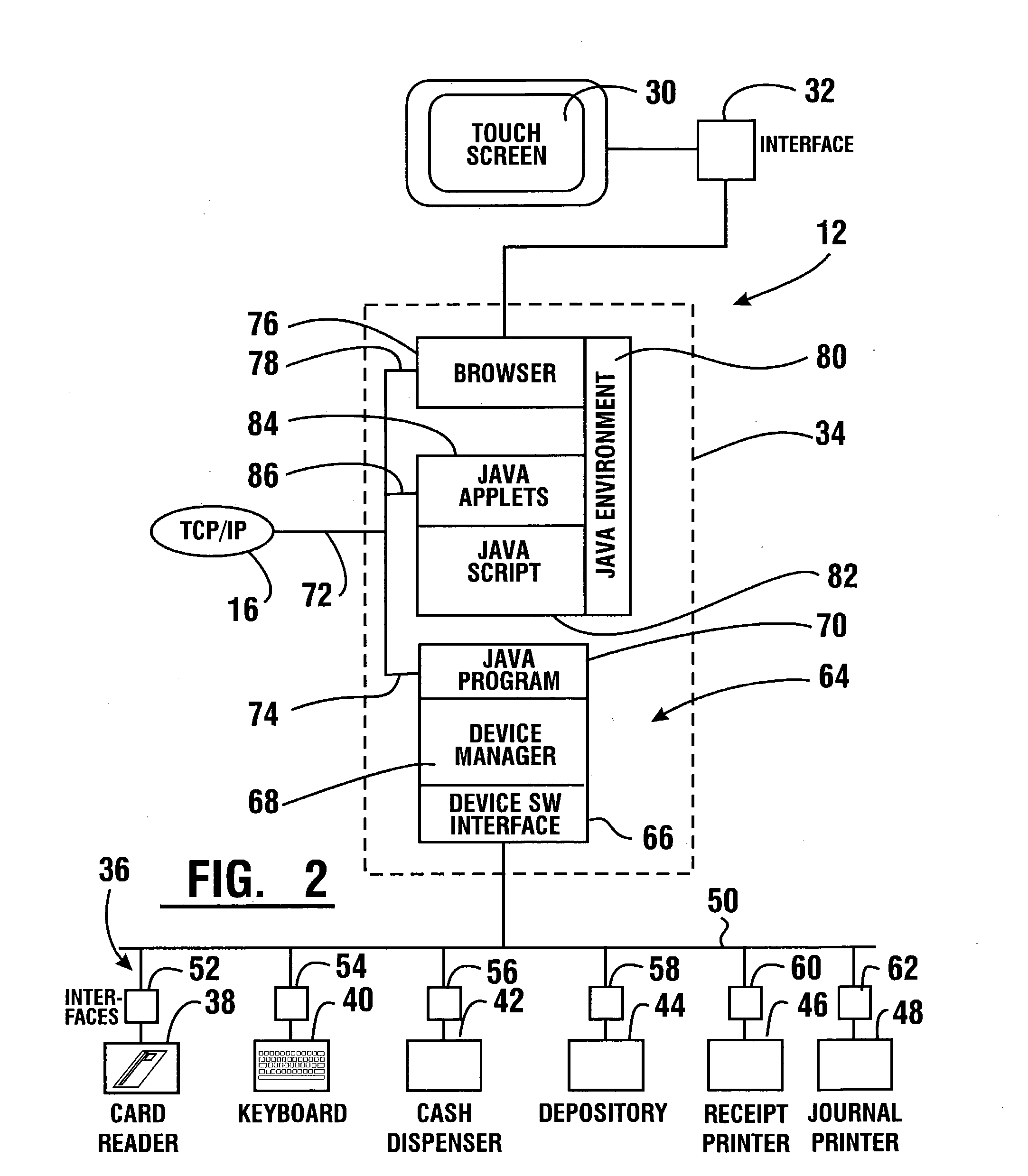

Automated banking machine system and method

InactiveUS20030217005A1Good user interfaceFunction increaseBuying/selling/leasing transactionsSpecific program execution arrangementsEmail addressCheque

A system and method of providing an electronic transaction receipt from a cash dispensing ATM. A bank host computer is operable to submit the receipt to a system address of record with the bank. The address of record corresponds to an e-mail address, phone number or other address associated with an account involved in the transaction. The receipt may include an image or images associated with the transaction. Thus, a user of an ATM is able to receive an electronic receipt corresponding to the ATM transaction. The system may also operate to image deposited checks deposited at an ATM. Copies of the imaged checks and other information can be electronically sent to a maker, payee, a clearinghouse or banks involved with the transaction. The system may also operate to provide the user with blank checks in hard copy or virtual checks for transactions.

Owner:DIEBOLD NIXDORF

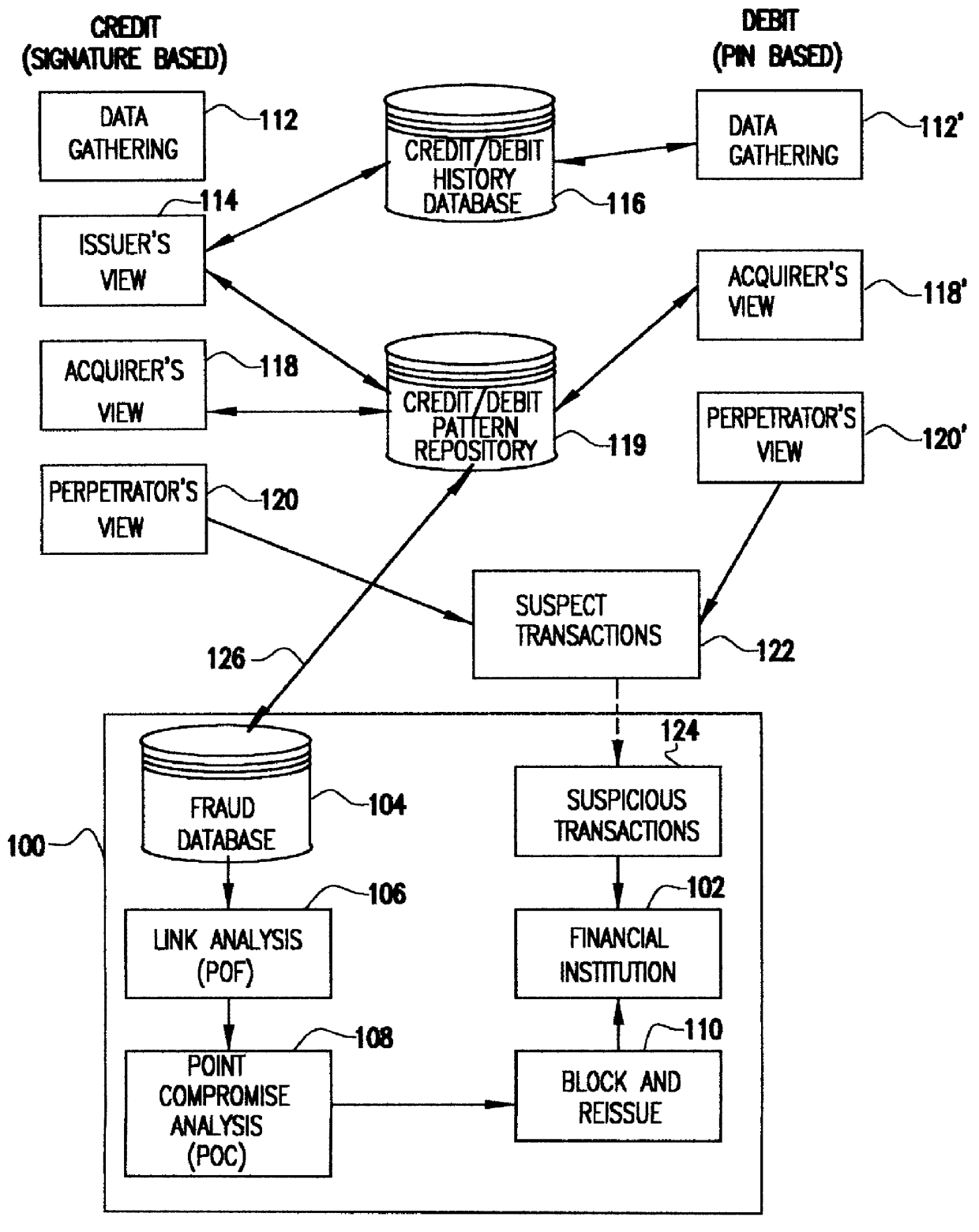

System for detecting counterfeit financial card fraud

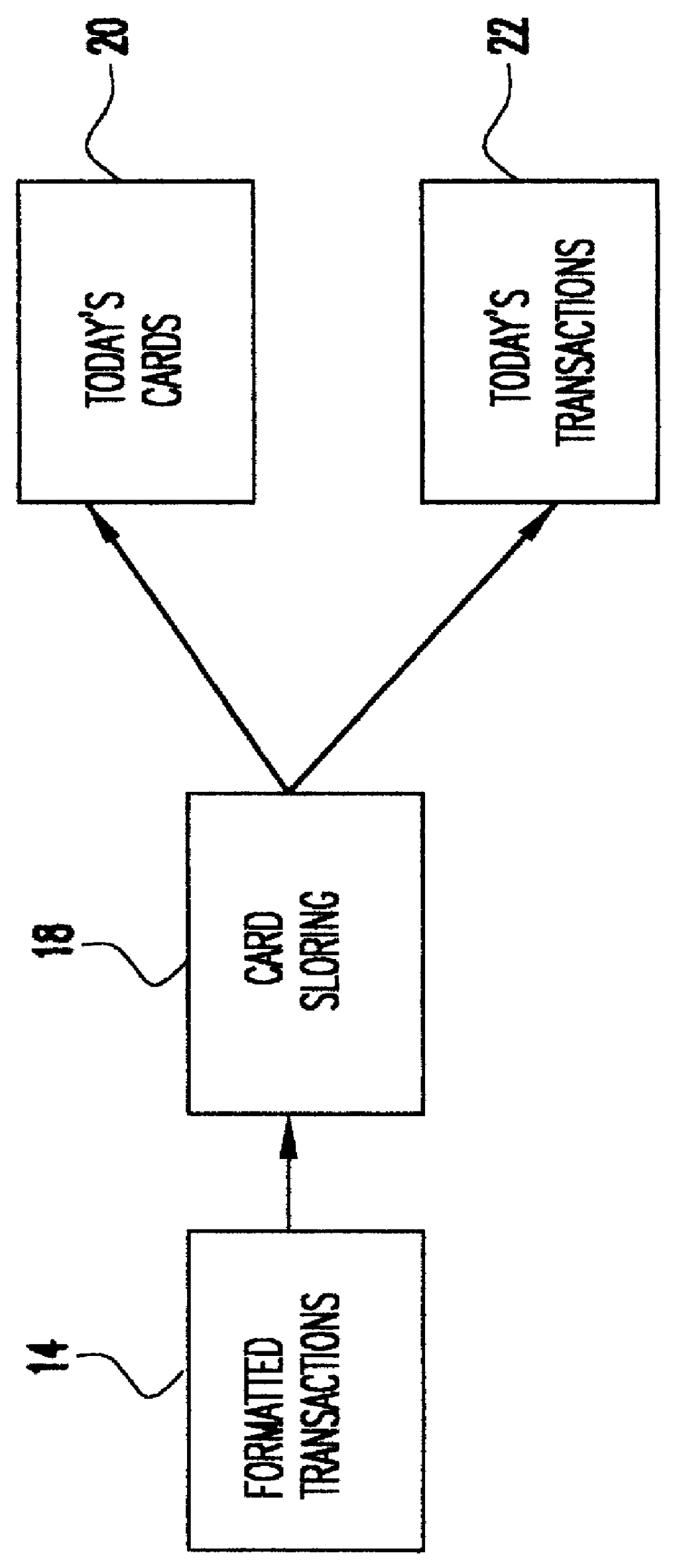

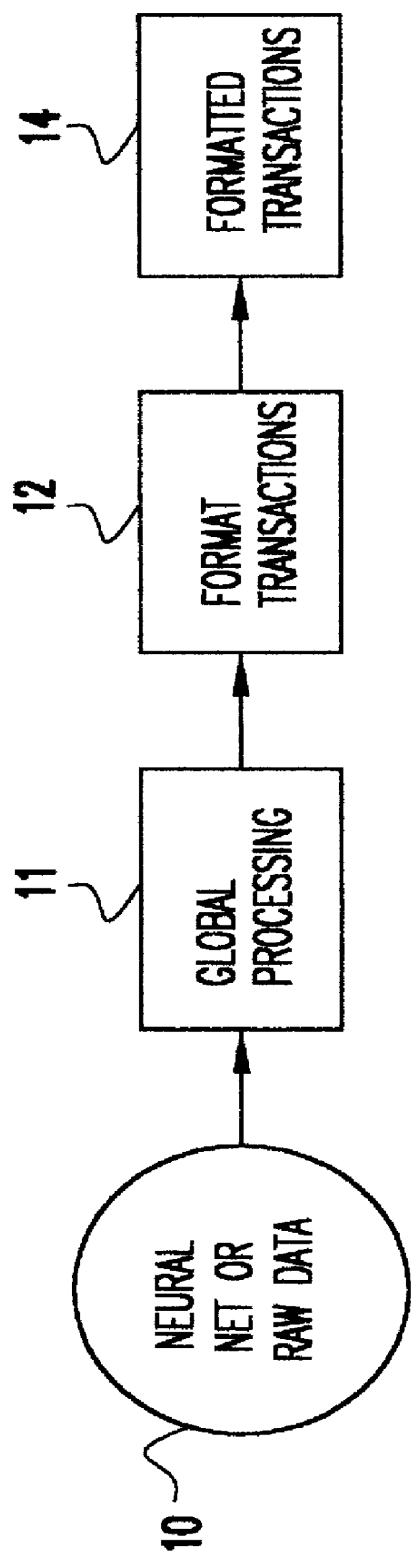

Counterfeit financial card fraud is detected based on the premise that the fraudulent activity will reflect itself in clustered groups of suspicious transactions. A system for detecting financial card fraud uses a computer database comprising financial card transaction data reported from a plurality of financial institutions. The transactions are scored by assigning weights to individual transactions to identify suspicious transactions. The geographic region where the transactions took place as well as the time of the transactions are recorded. An event building process then identifies cards involved in suspicious transactions in a same geographic region during a common time period to determine clustered groups of suspicious activity suggesting an organized counterfeit card operation which would otherwise be impossible for the individual financial institutions to detect.

Owner:FAIR ISAAC & CO INC

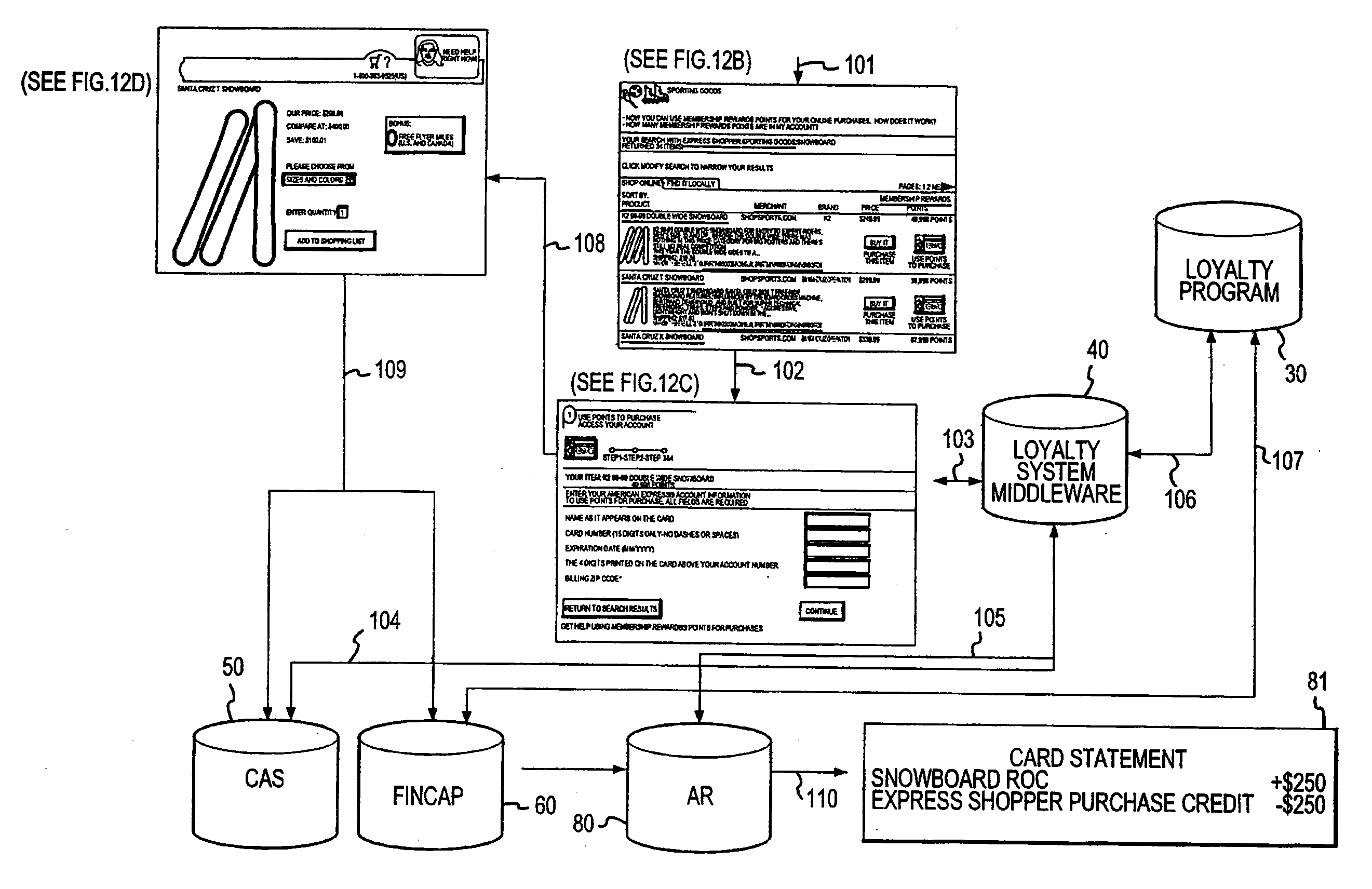

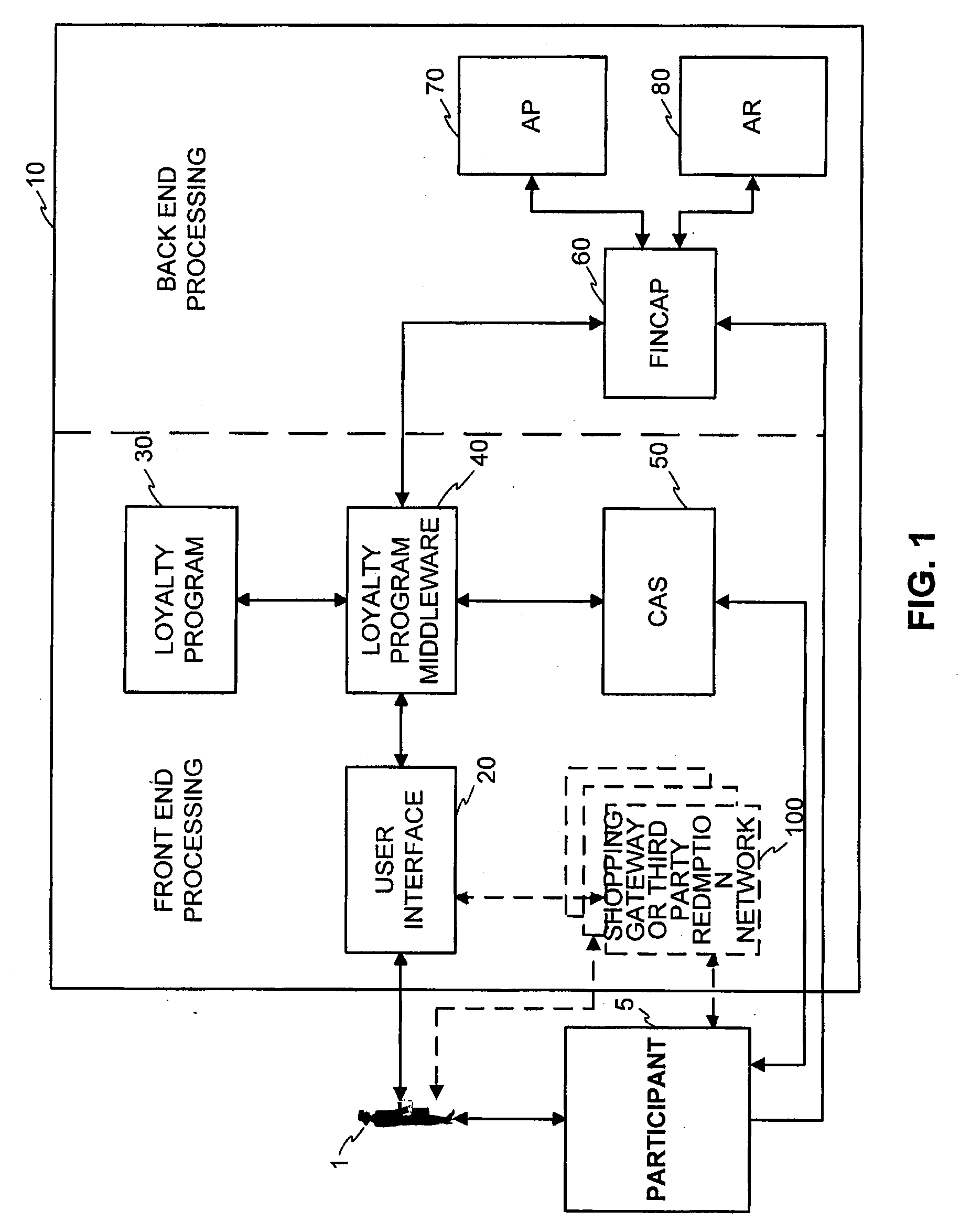

System and Method for Issuing and Using a Loyalty Point Advance

InactiveUS20090106112A1Convenient transactionComplete banking machinesFinanceLoyalty programComputer science

A system and method for spending loyalty points over a computerized network to facilitate a loyalty point transaction is disclosed. The system enables a participant of a loyalty program to accept an advance of loyalty point when a loyalty account balance is insufficient to make a desired purchase. An amount of loyalty points available as an advance to a participant is determined based on a number of criteria related to the participant, financial account activity, and loyalty account activity. The participant is allotted a predetermined length of time to earn or purchase enough loyalty points to repay the balance of advanced loyalty points. If, at the conclusion of such predetermined length of time, sufficient points have not been earned to offset the loyalty point advance, the participant is charged the currency value of each outstanding loyalty point. The participant may be assessed interest charges and / or fees at the time of the loyalty point advance, during reimbursement, or at the end of a time period for reimbursement.

Owner:LIBERTY PEAK VENTURES LLC

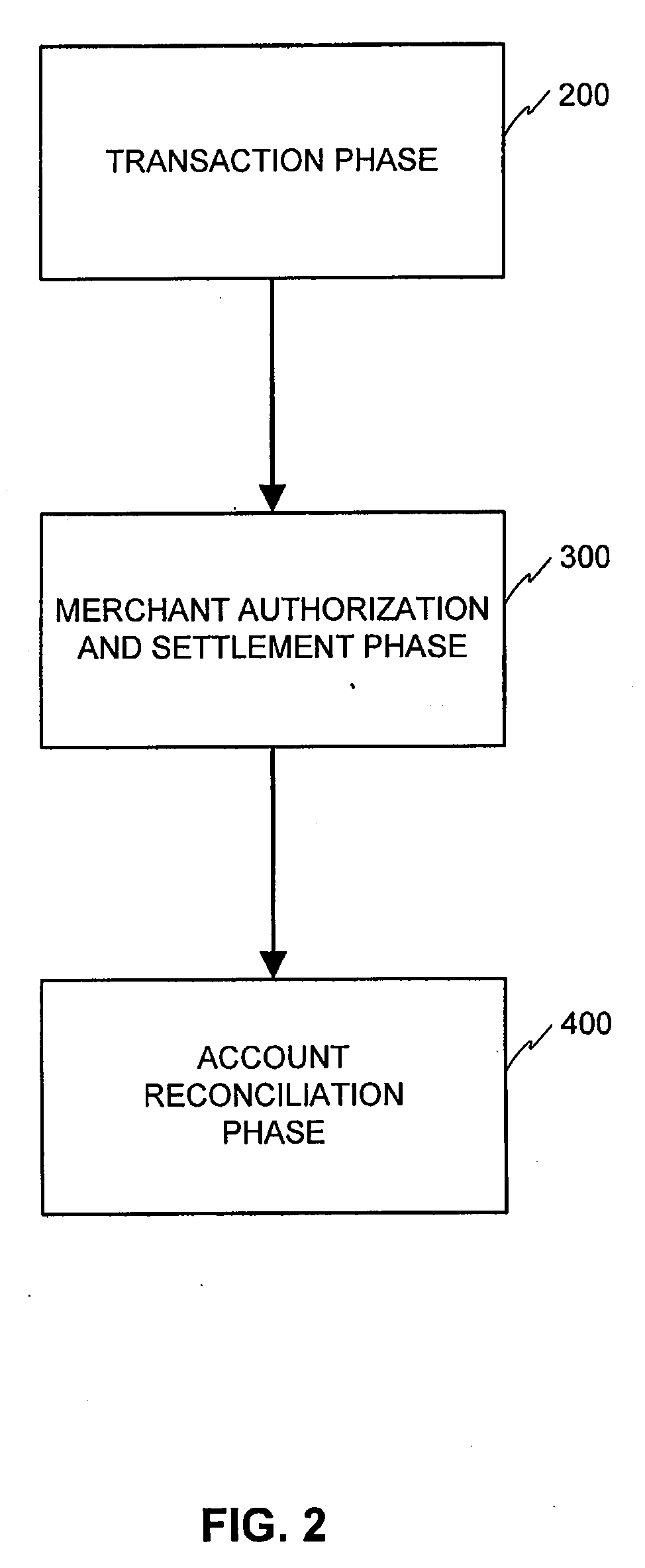

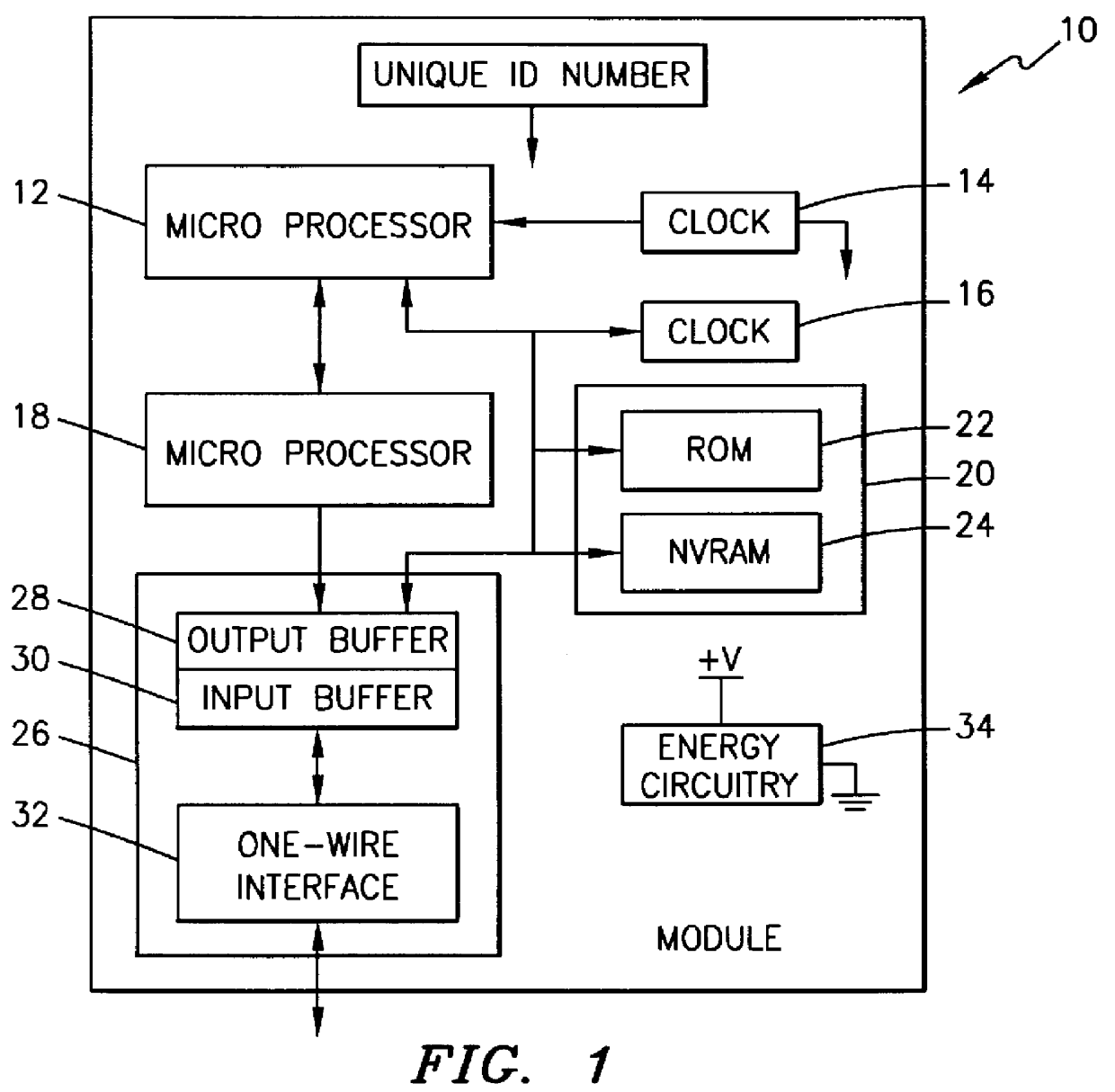

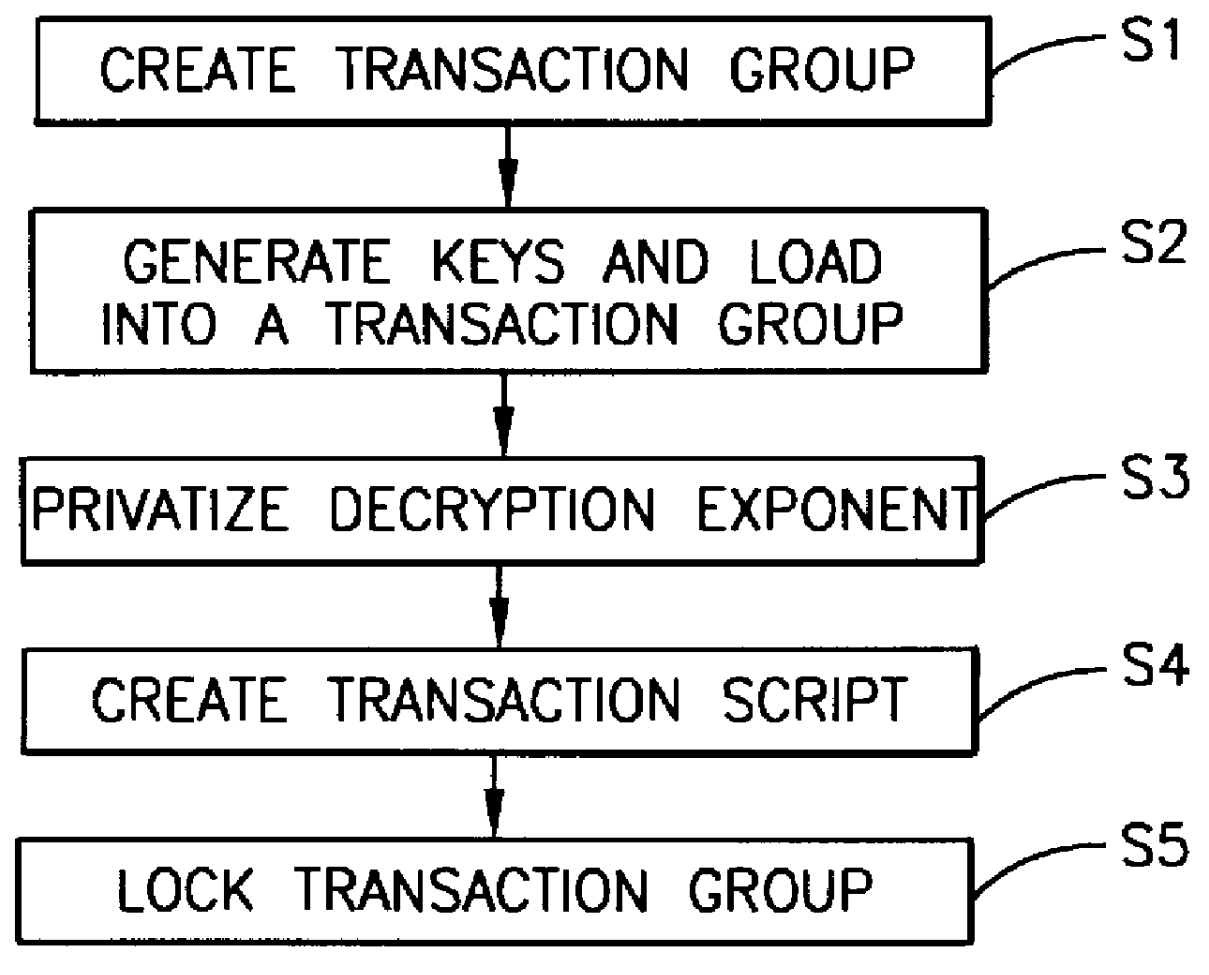

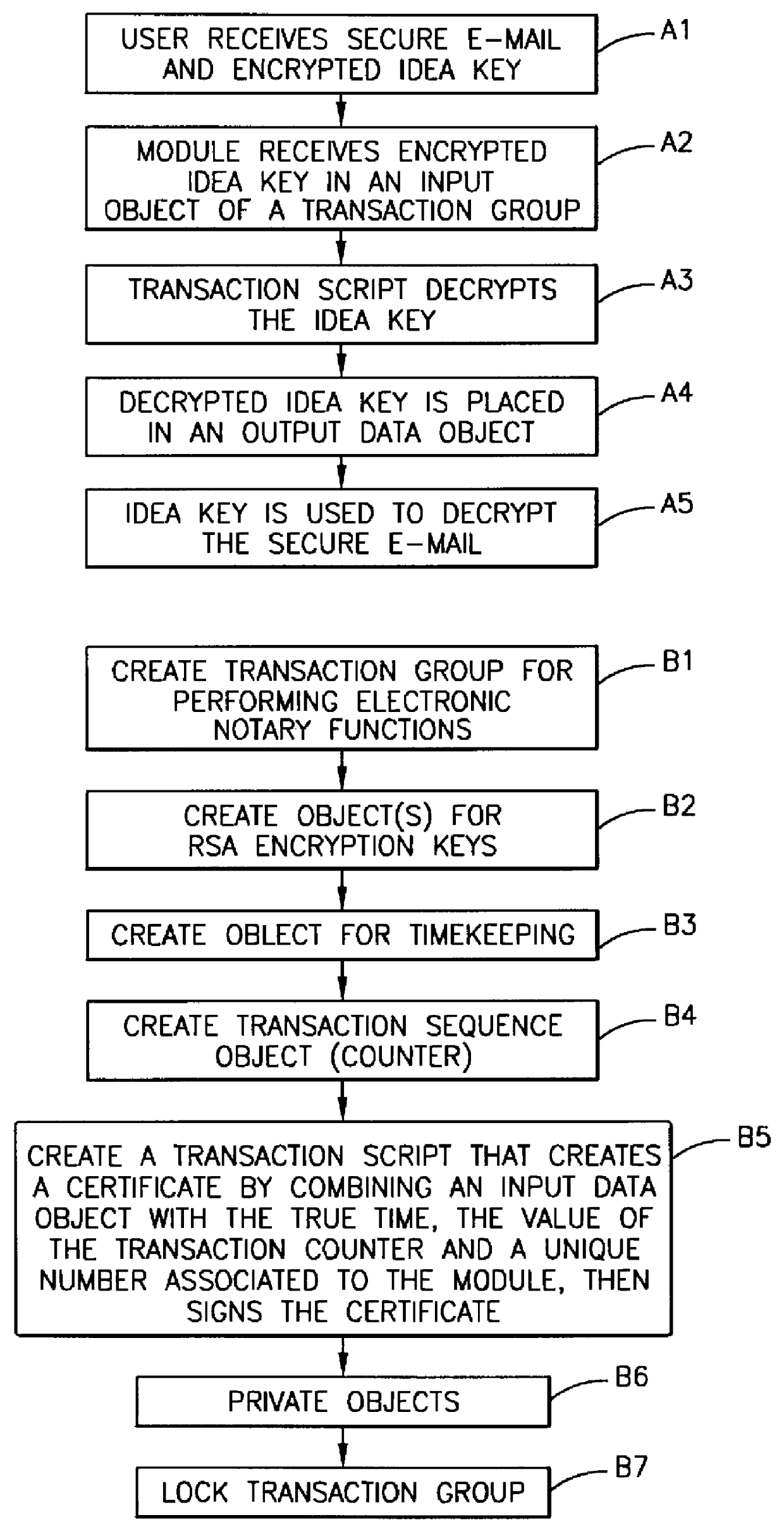

Method, apparatus, system and firmware for secure transactions

The present invention relates to an electronic module used for secure transactions. More specifically, the electronic module is capable of passing information back and forth between a service provider's equipment via a secure, encrypted technique so that money and other valuable data can be securely passed electronically. The module is capable of being programmed, keeping track of real time, recording transactions for later review, and creating encryption key pairs.

Owner:MAXIM INTEGRATED PROD INC

Apparatus and method for facilitating money or value transfer

An apparatus and method for transferring money or value, using a wide range of interfaces to initiate a transfer and a wide range of options for receiving the transfer, including receiving the transferred sum directly to the communication device / account of the receiver. The receiver can use the transferred sum as an airtime credit, to obtain cash or to pay for other goods or services.

Owner:HIP CONSULT

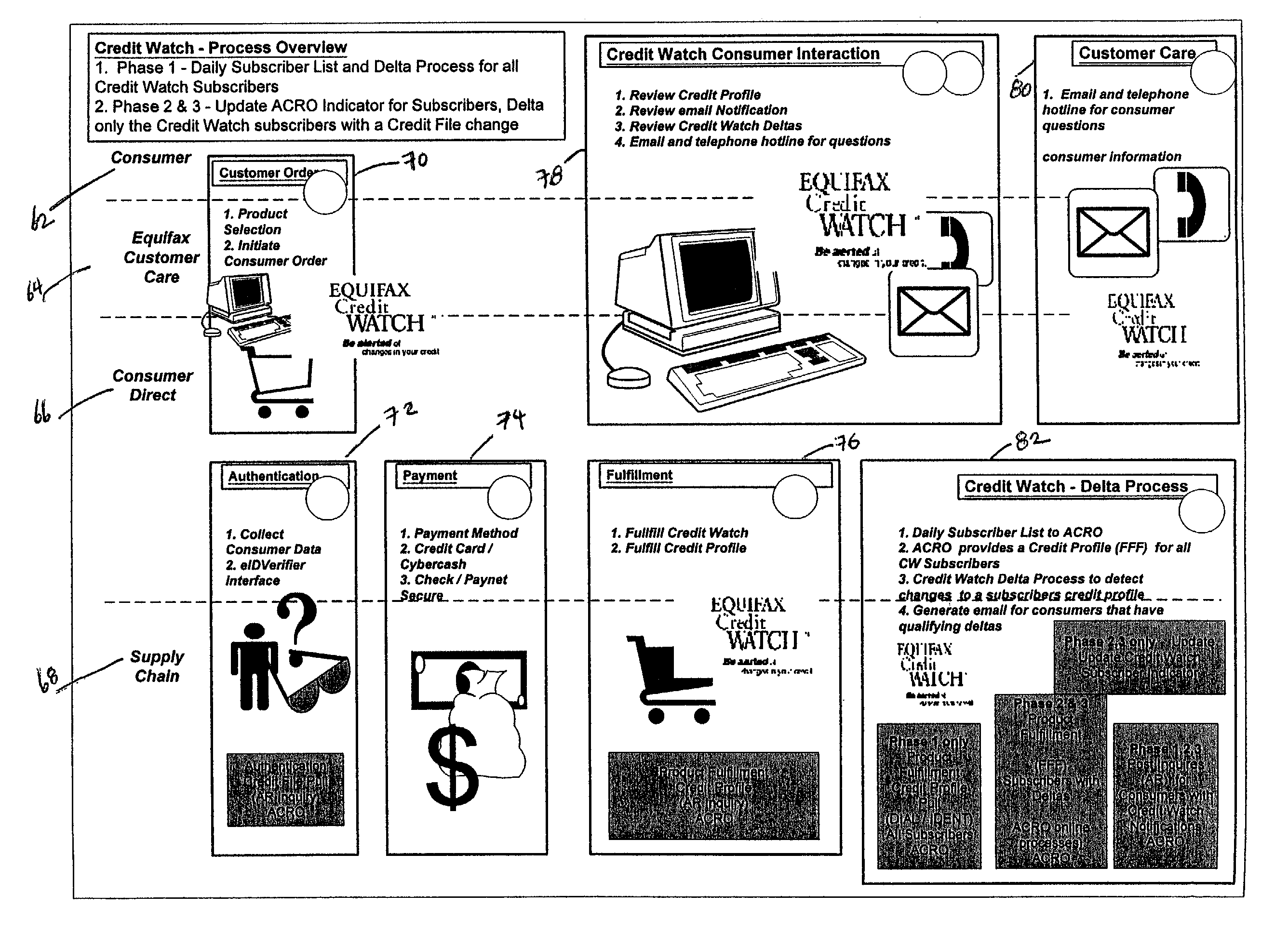

Systems and methods for notifying a consumer of changes made to a credit report

A system and method for monitoring unauthorized changes to a database and providing a notification to a user according to preferences set by the user. The user can select one or more data entries within a database to be monitored. When these data entries are changed, a notification is sent to the user.

Owner:EQUIFAX INC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com