Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

1185 results about "Cheque" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

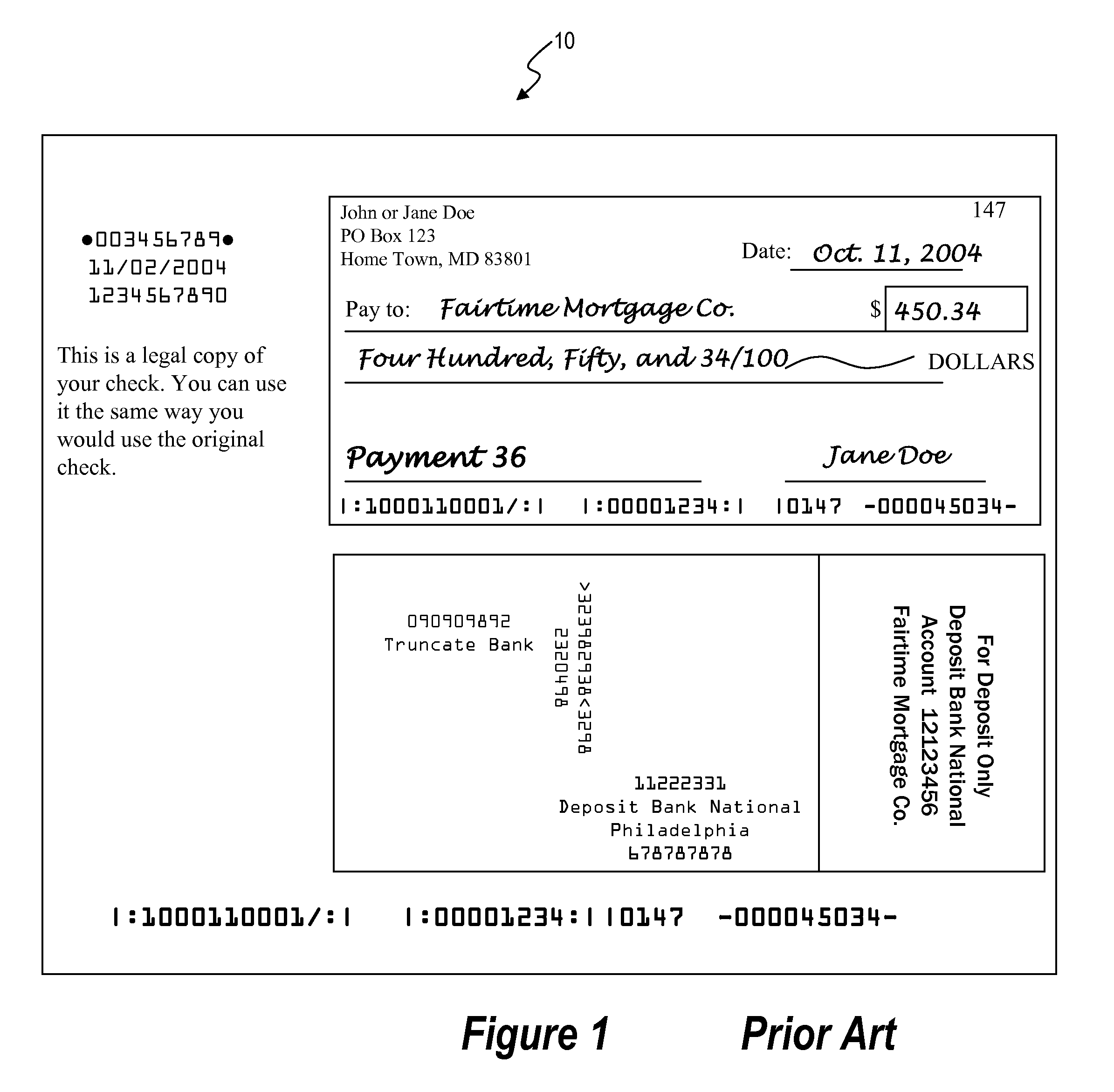

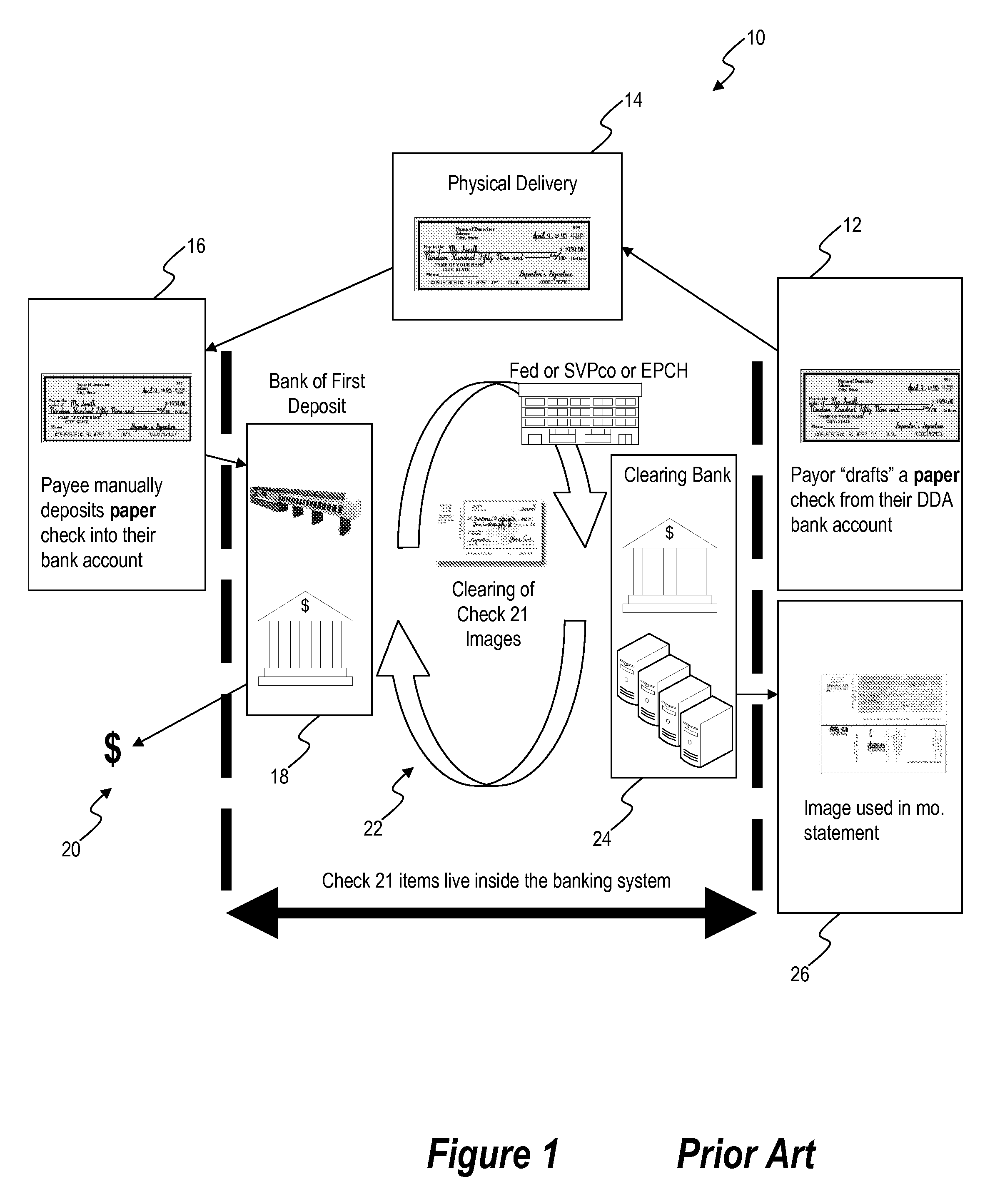

A cheque, or check (American English; see spelling differences), is a document that orders a bank to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the drawer, has a transaction banking account (often called a current, cheque, chequing or checking account) where their money is held. The drawer writes the various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the drawee, to pay that person or company the amount of money stated.

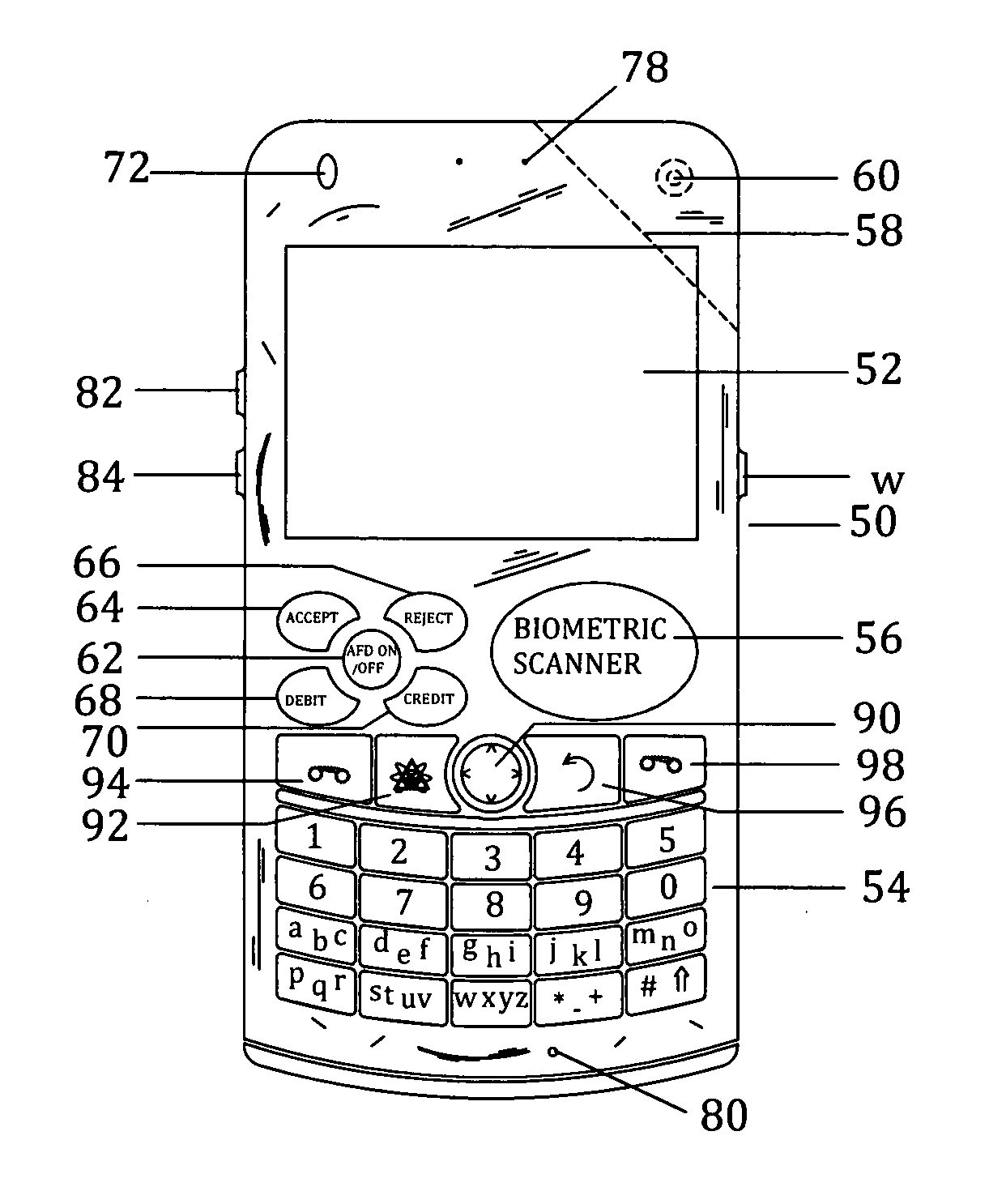

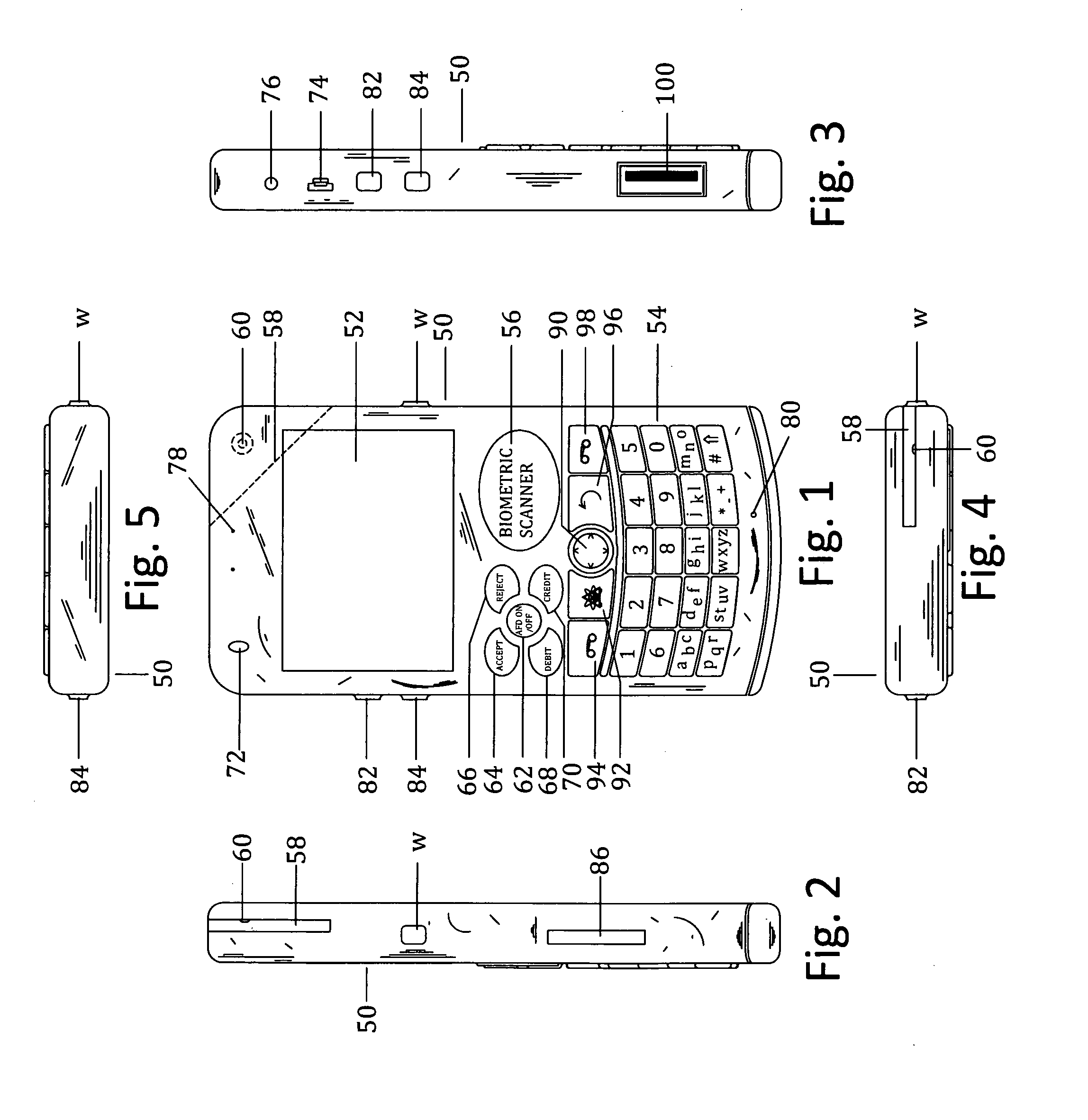

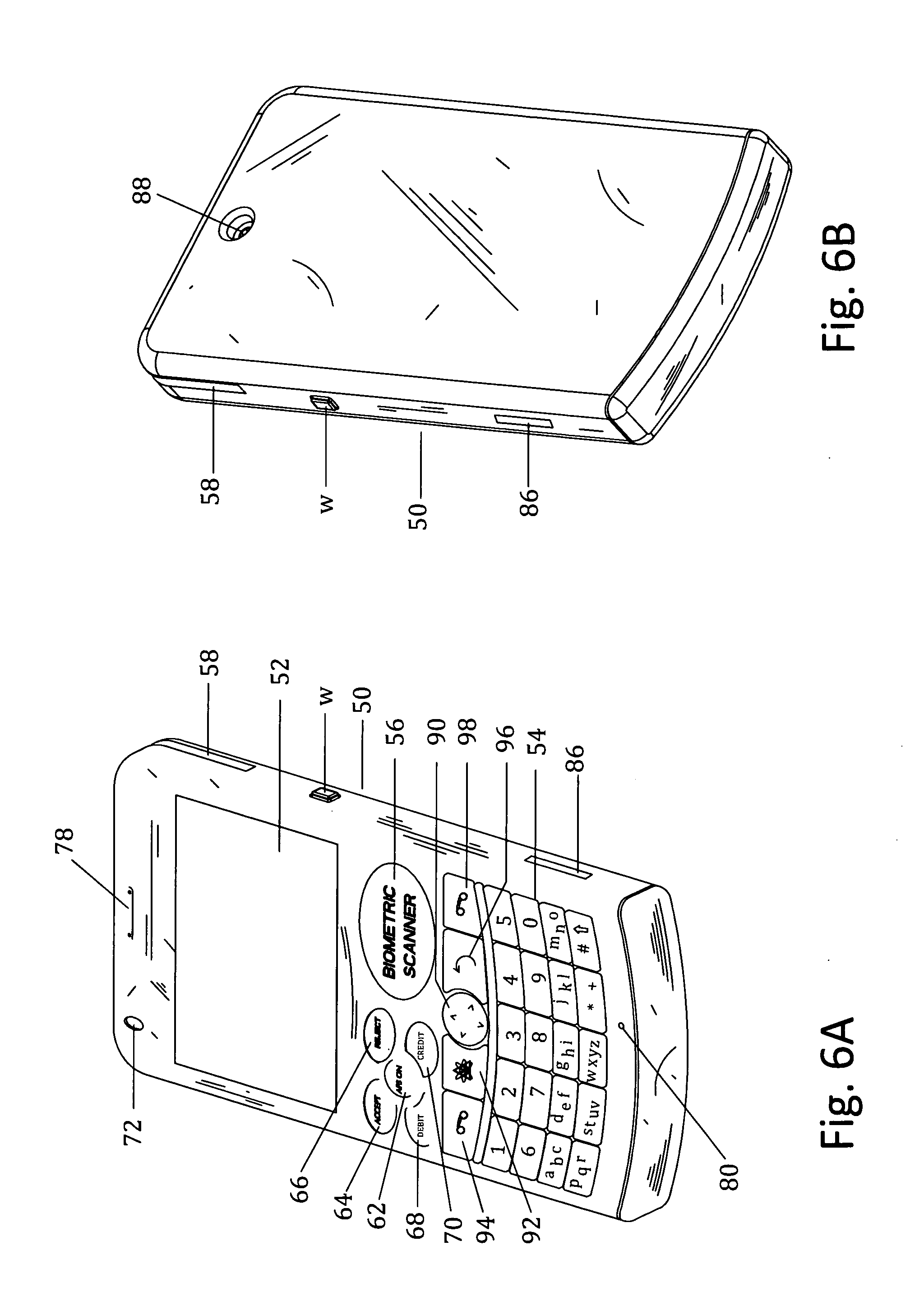

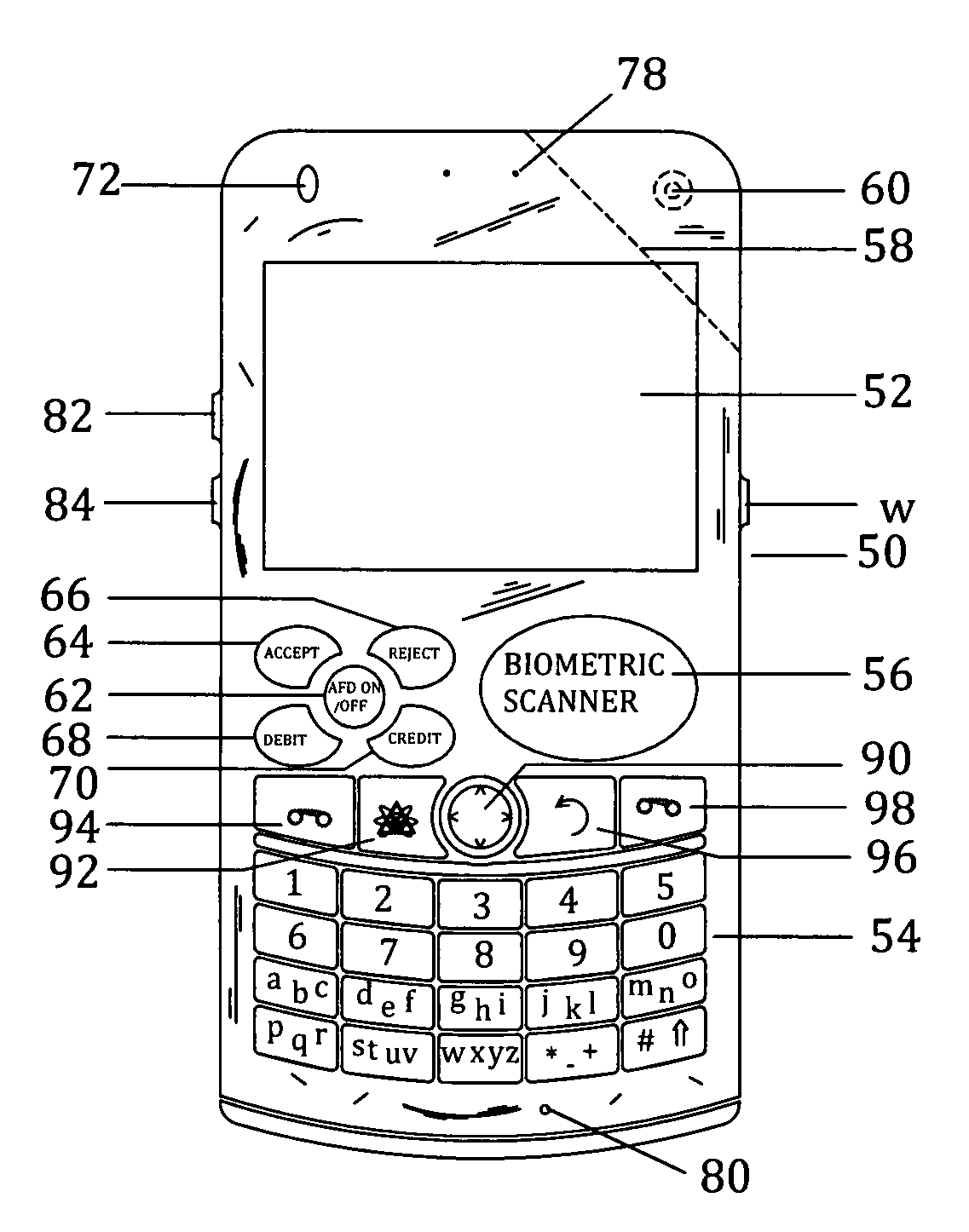

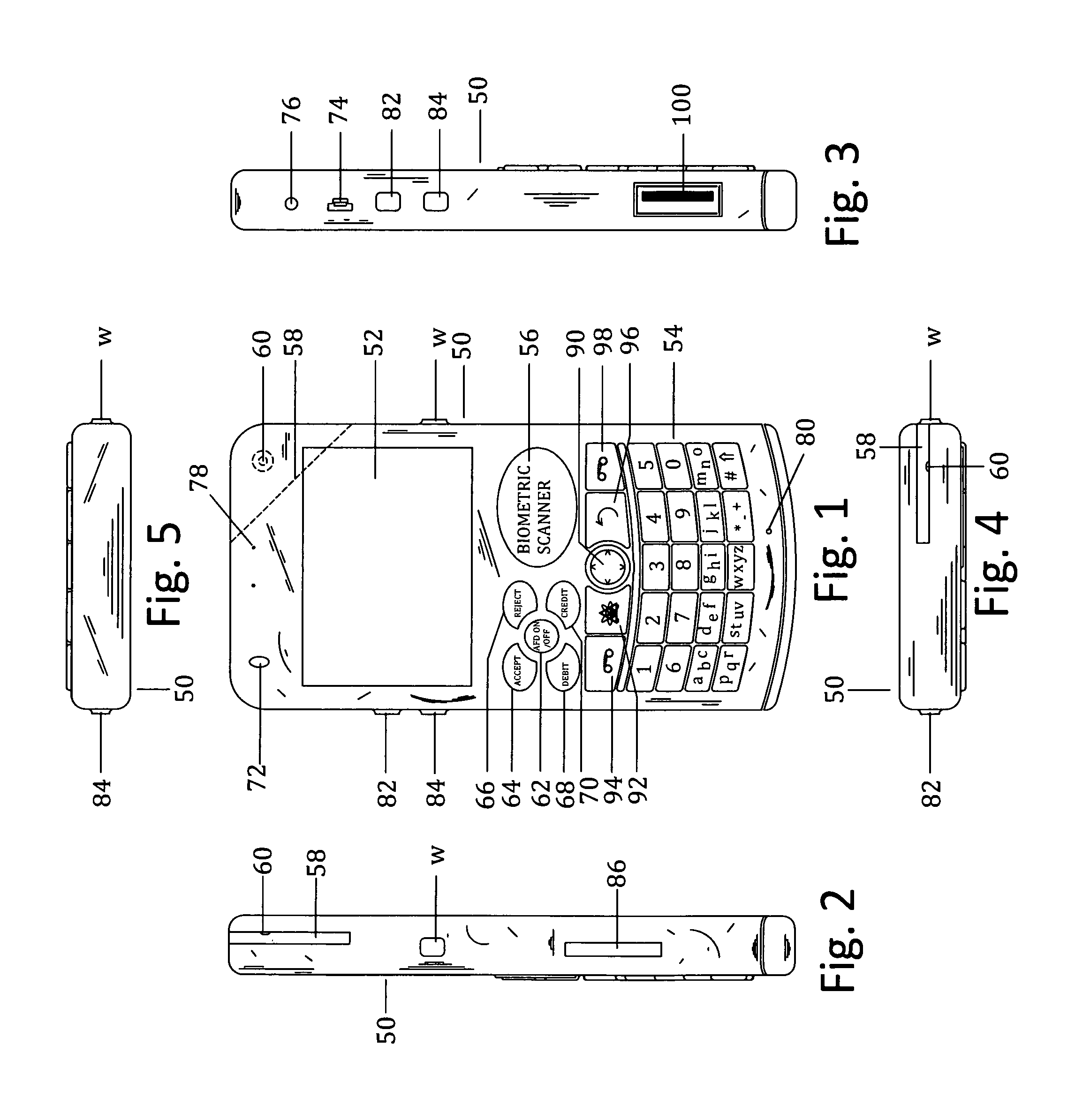

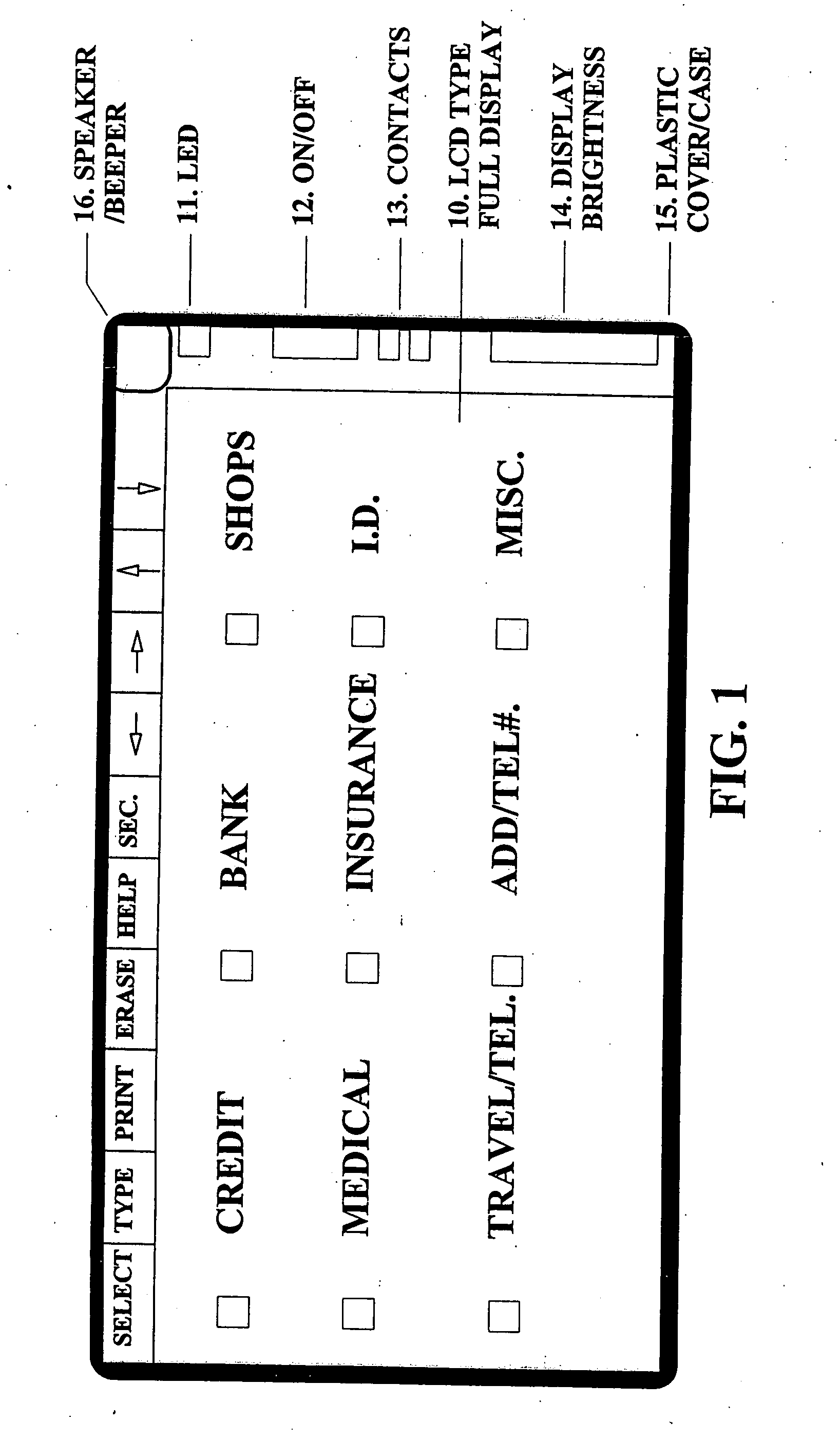

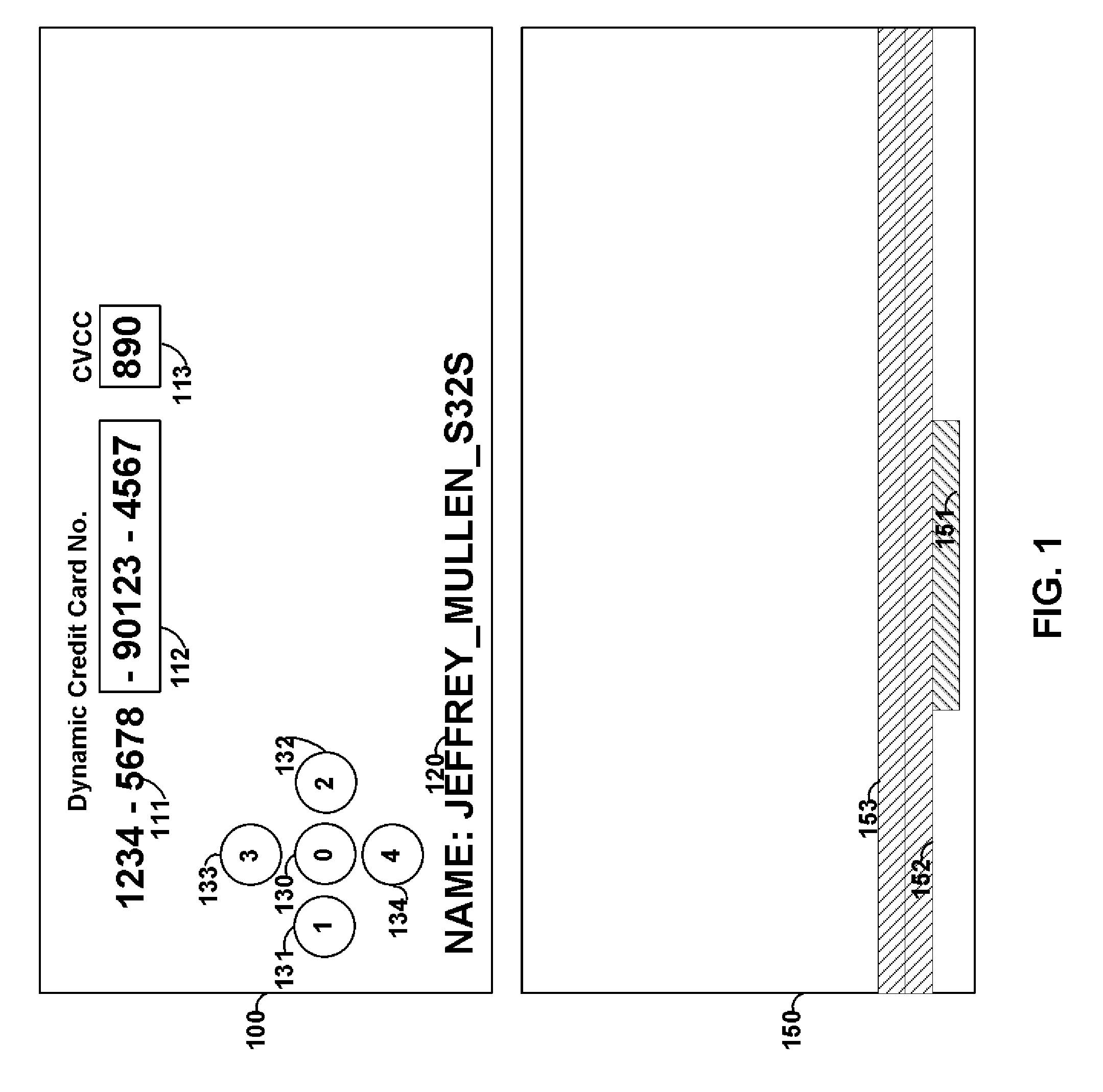

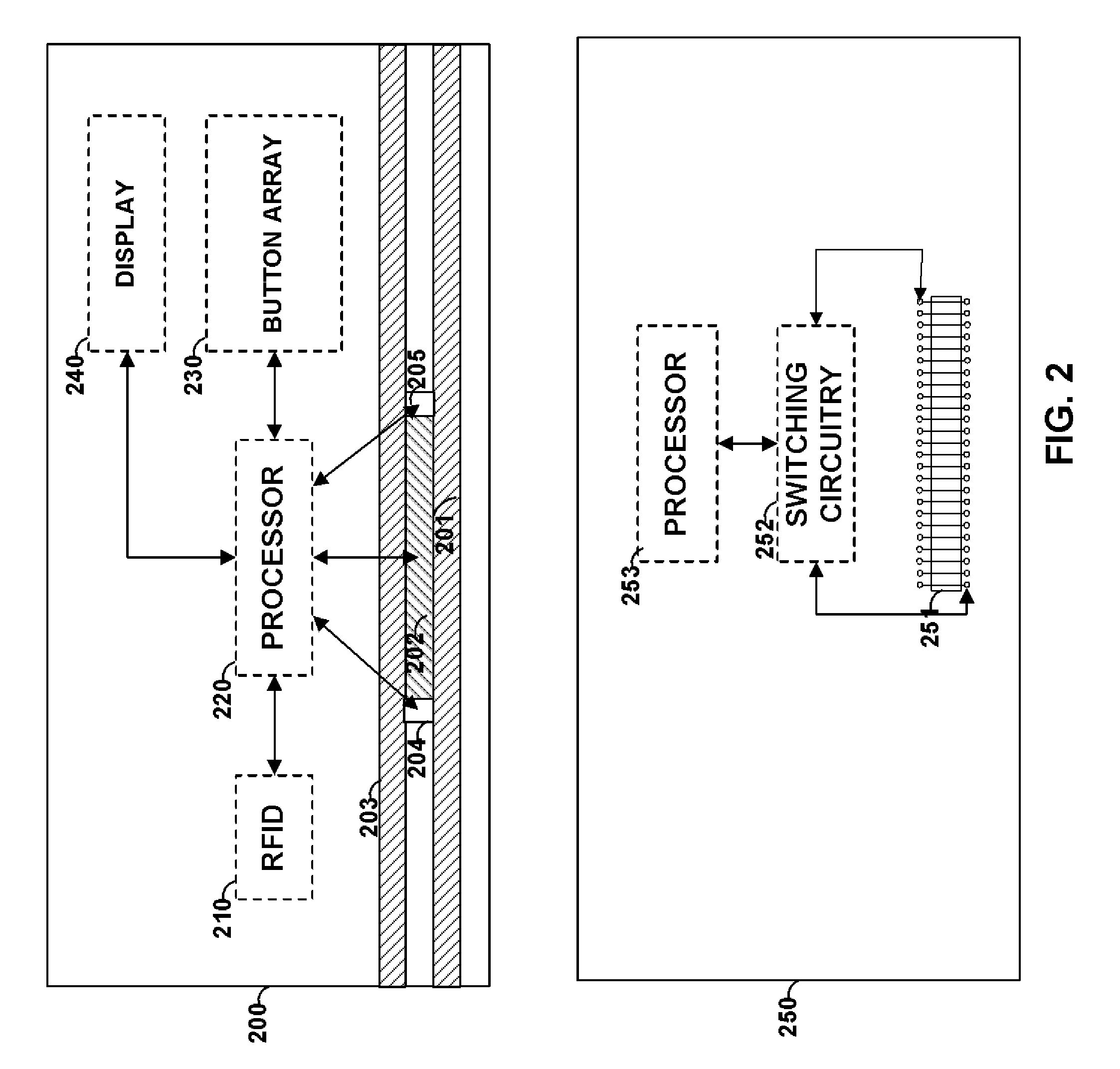

Customer-controlled instant-response anti-fraud/anti-identity theft devices (with true- personal identity verification), method and systems for secured global applications in personal/business e-banking, e-commerce, e-medical/health insurance checker, e-education/research/invention, e-disaster advisor, e-immigration, e-airport/aircraft security, e-military/e-law enforcement, with or without NFC component and system, with cellular/satellite phone/internet/multi-media functions

ActiveUS20140162598A1Prevent fraudulent multiple swipingDevices with card reading facilityUnauthorised/fraudulent call preventionChequeMessage passing

All-in-one wireless mobile telecommunication devices, methods and systems providing greater customer-control, instant-response anti-fraud / anti-identity theft protections with instant alarm, messaging and secured true-personal identity verifications for numerous registered customers / users, with biometrics and PIN security, operating with manual, touch-screen and / or voice-controlled commands, achieving secured rapid personal / business e-banking, e-commerce, accurate transactional monetary control and management, having interactive audio-visual alarm / reminder preventing fraudulent usage of legitimate physical and / or virtual credit / debit cards, with cheques anti-forgery means, curtailing medical / health / insurance frauds / identity thefts, having integrated cellular and / or satellite telephonic / internet and multi-media means, equipped with language translations, GPS navigation with transactions tagging, currency converters, with or without NFC components, minimizing potential airport risks / mishaps, providing instant aid against school bullying, kidnapping, car-napping and other crimes, applicable for secured military / immigration / law enforcements, providing guided warning / rescue during emergencies and disasters.

Owner:VILLA REAL ANTONY EUCLID C

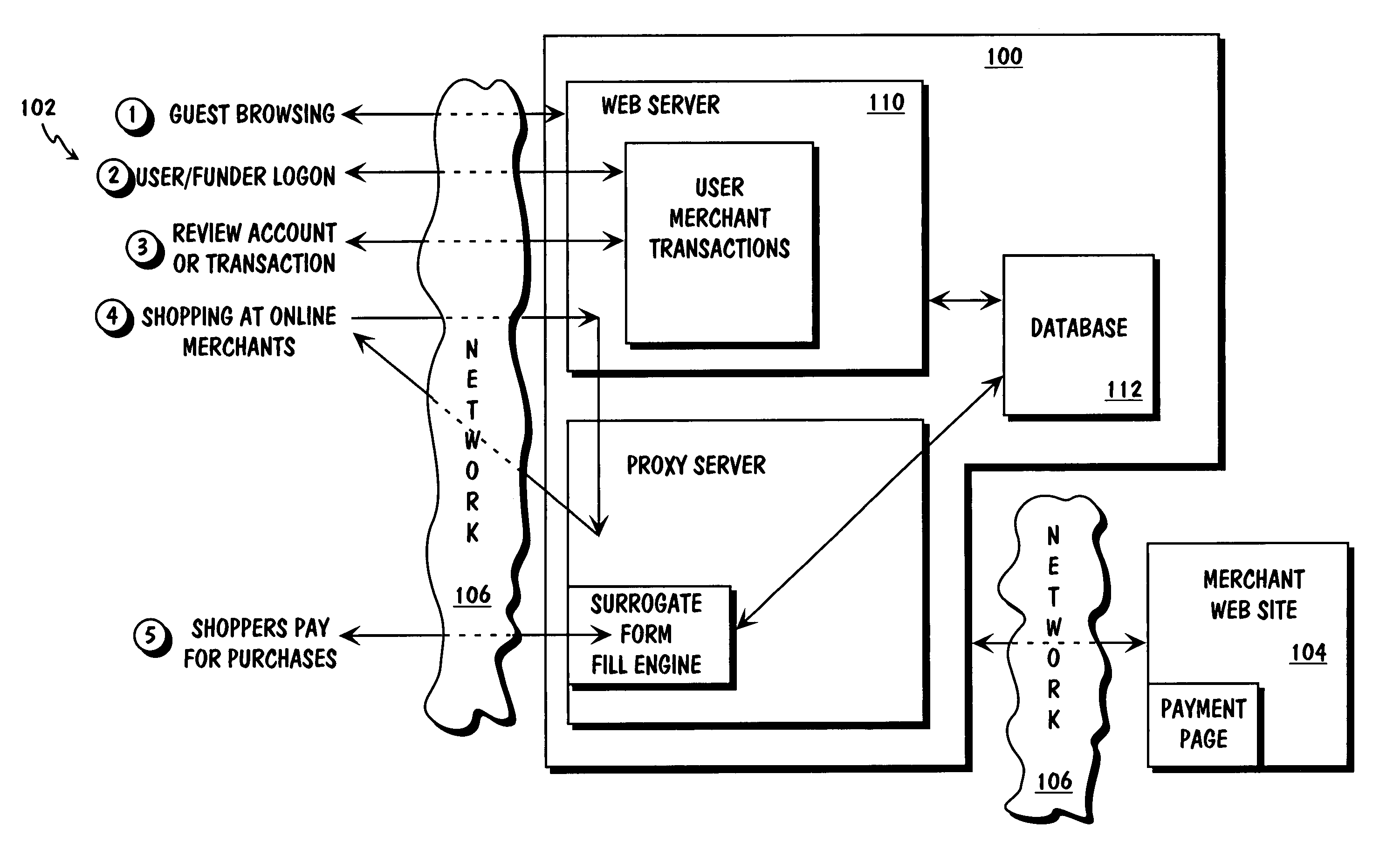

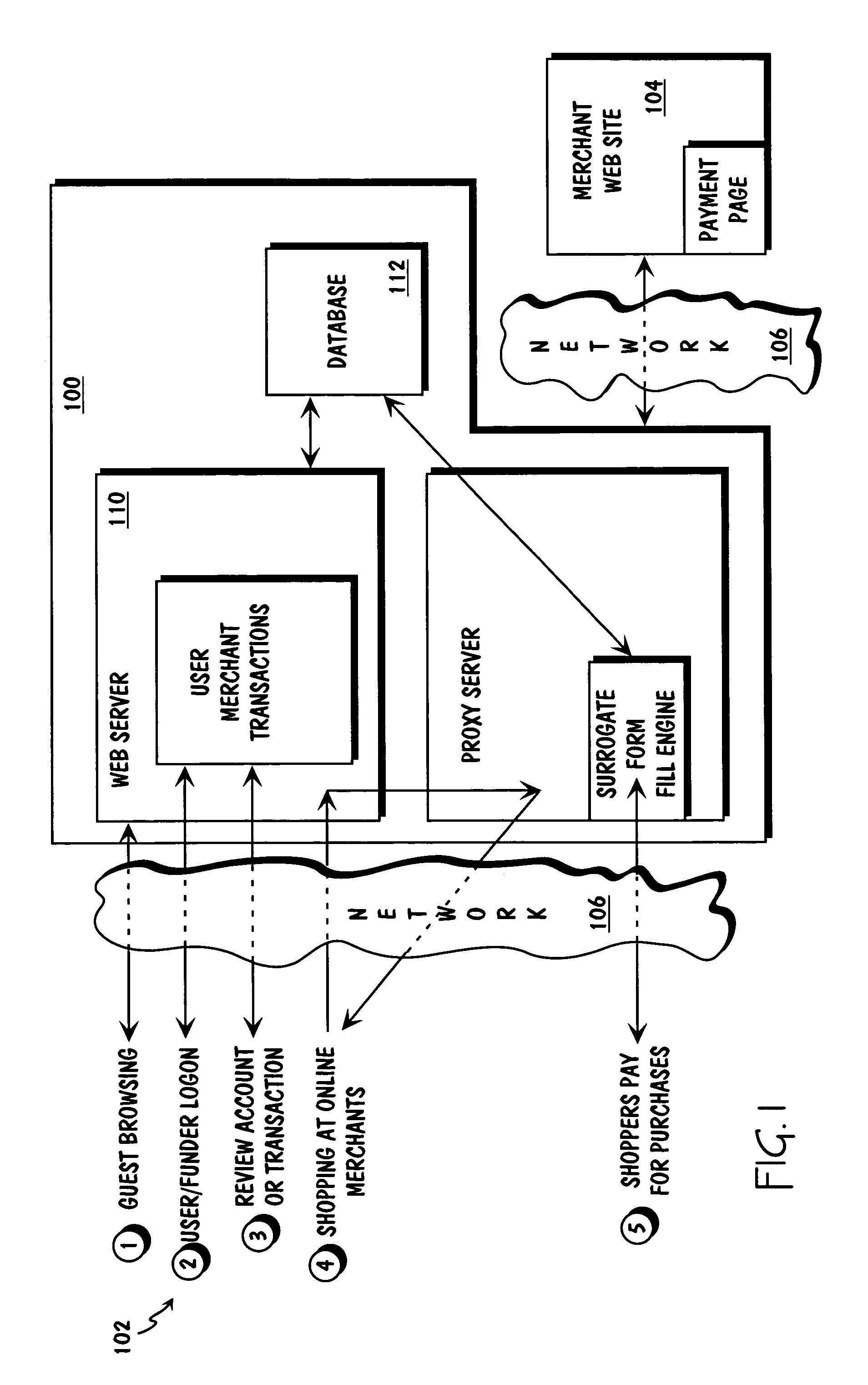

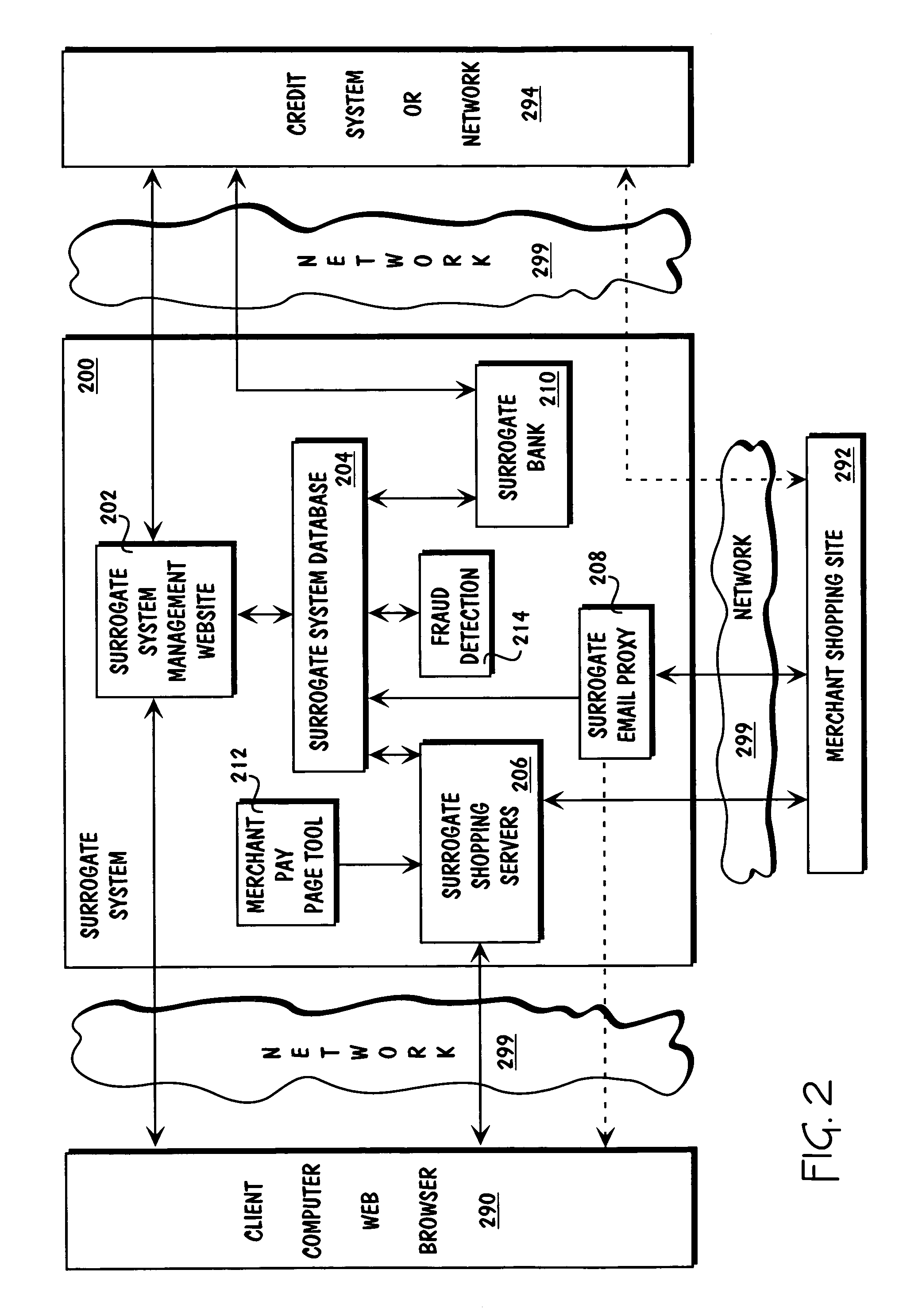

Method and apparatus for surrogate control of network-based electronic transactions

A surrogate system for the transparent control of electronic commerce transactions is provided through which an individual without a credit card is enabled to shop at online merchant sites. Upon opening an account within the surrogate system, the account can be funded using numerous fund sources, for example credit cards, checking accounts, money orders, gift certificates, incentive codes, online currency, coupons, and stored value cards. A user with a funded account can shop at numerous merchant web sites through the surrogate system. When merchandise is selected for purchase, a purchase transaction is executed in which a credit card belonging to the surrogate system is temporarily or permanently assigned to the user. The credit card, once loaded with funds from the user's corresponding funded account, is used to complete the purchase transaction. The surrogate system provides controls that include monitoring the data streams and, in response, controlling the information flow between the user and the merchant sites.

Owner:THE COCA-COLA CO

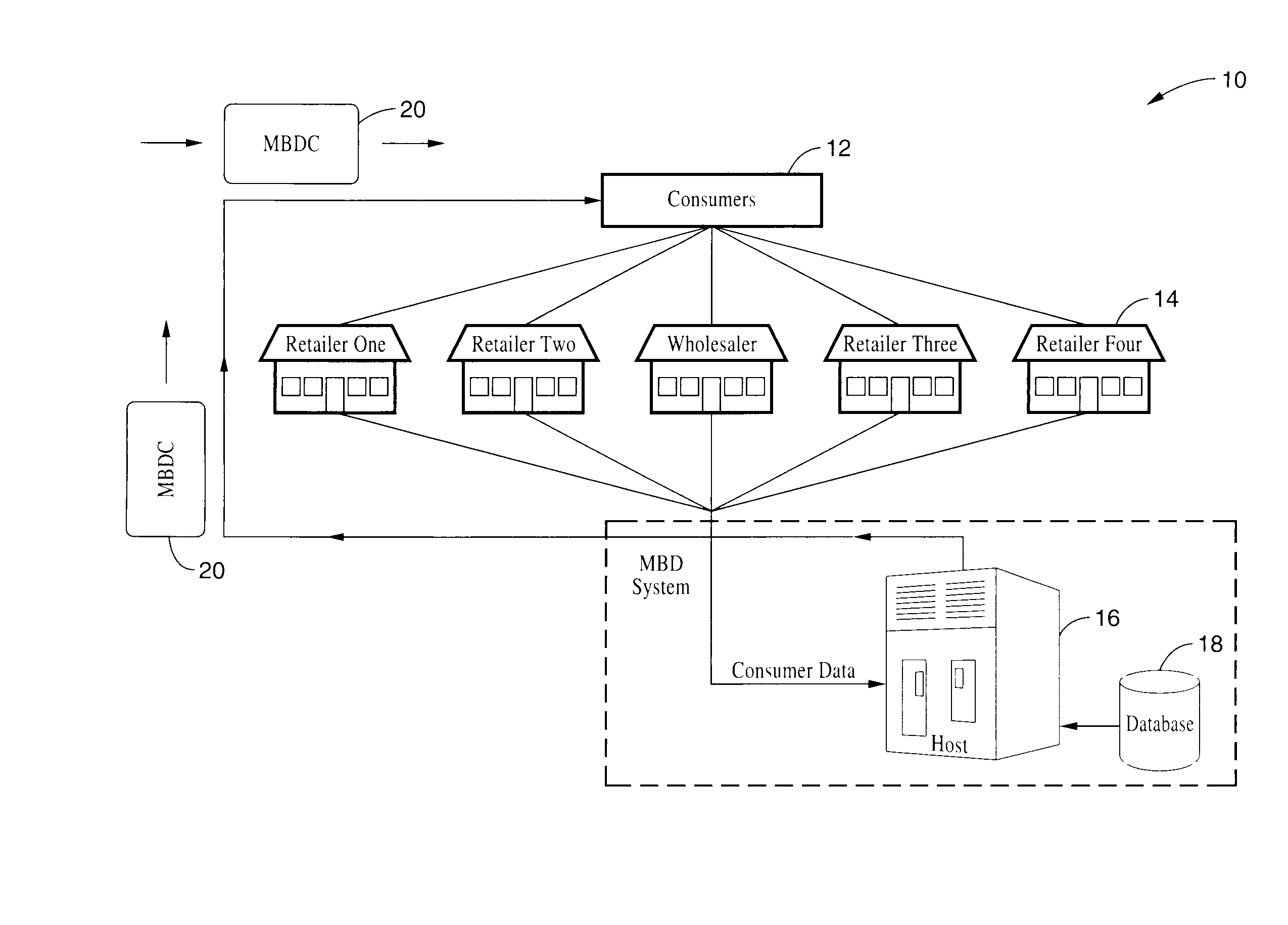

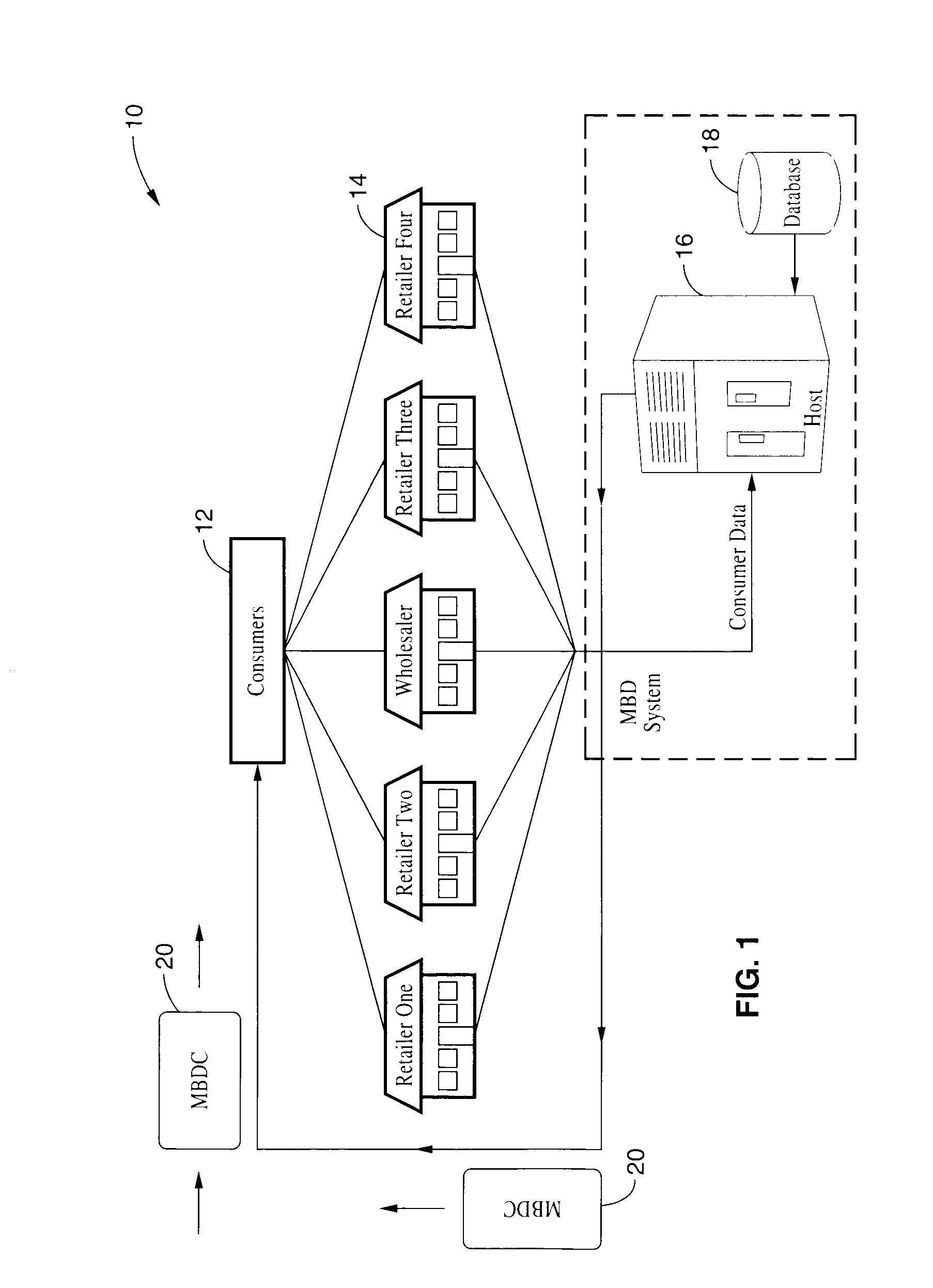

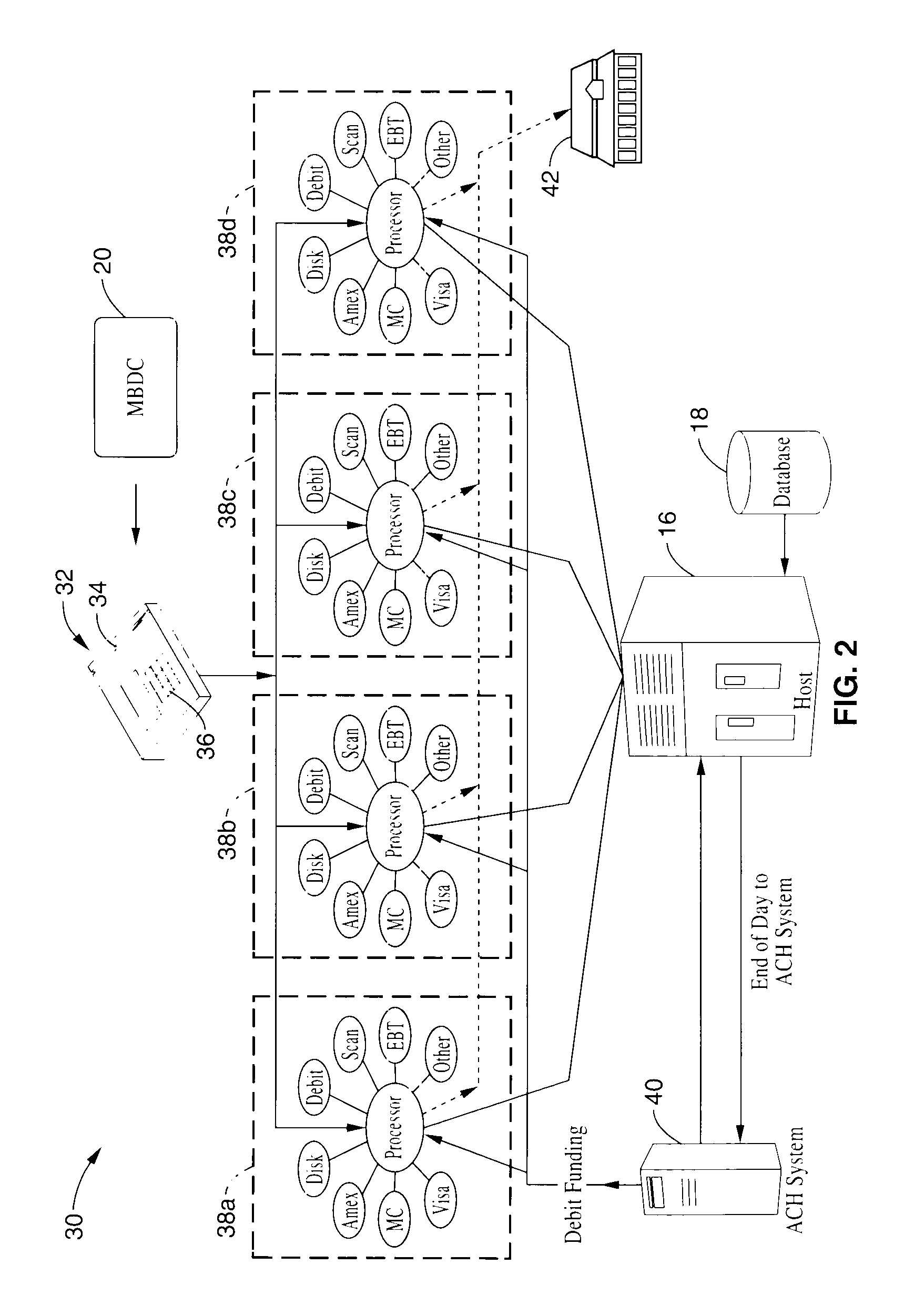

Method and system for facilitating electronic funds transactions

InactiveUS7104443B1Measurement is limitedReduce transaction costsComplete banking machinesFinanceInformation sharingMerchant account

A method and system for executing electronic funds transactions using a merchant based debit (MBD) card in a merchant-centric system that provides for reduced fees to acquiring merchants and remitting a portion of the collected fees to issuing merchants. The system also preferably provides information sharing on consumer transactions with merchants to facilitate consumer based incentive programs and the like. The system operates over conventional card processing infrastructure and utilizes the ACH network, or equivalent, to settle the transaction from a consumer checking account, or a merchant account in the case of a prepaid MBD card. Using the system, merchants may elect to qualify customers based on their own criterion. A portion of the interchange fee is distributed to the issuing merchant associated transaction executed using the merchant based debit card. Embodiments are described for prepaid, fixed value, programmable, and refillable, forms of merchant based debit cards.

Owner:KIOBA PROCESSING LLC

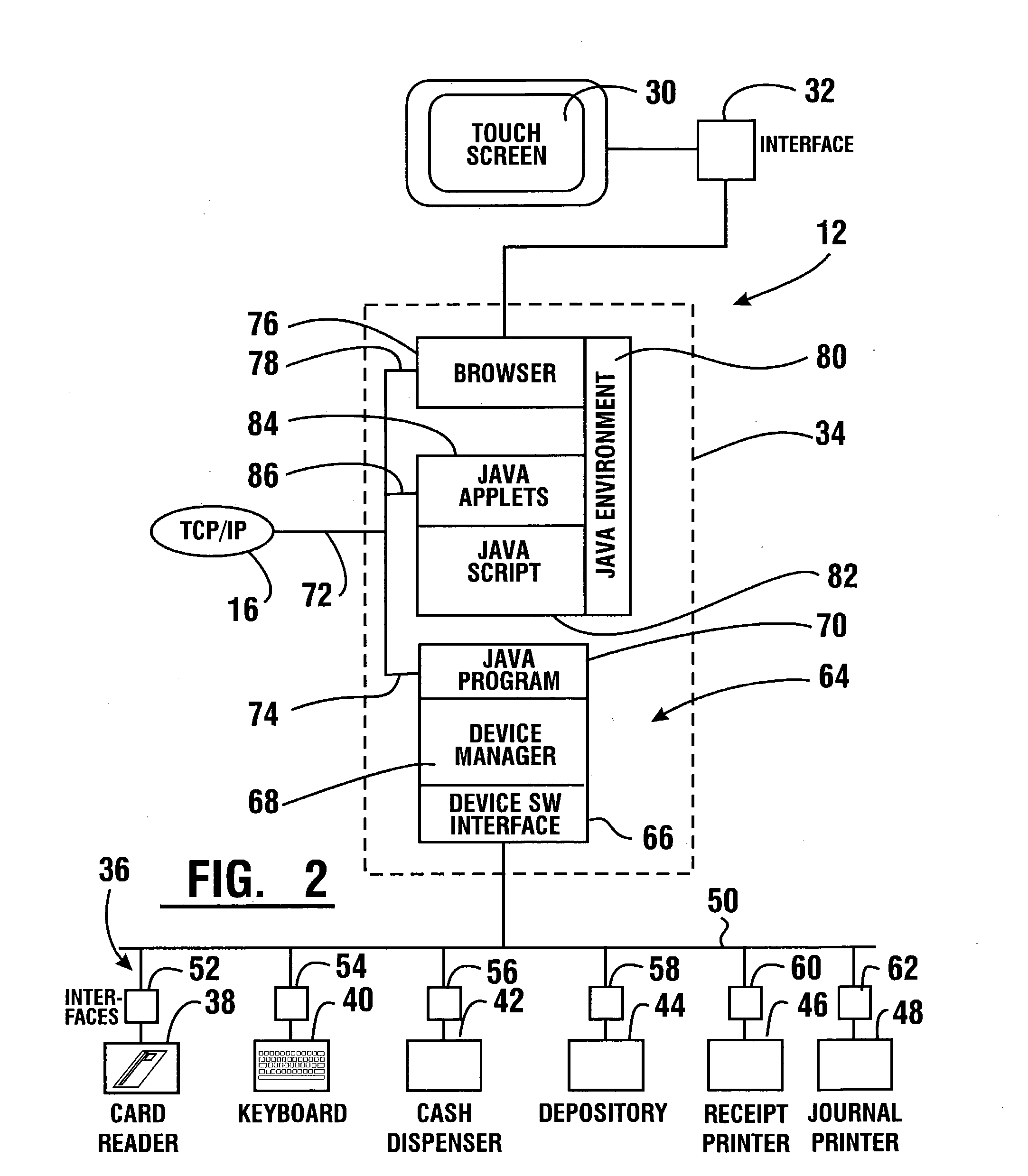

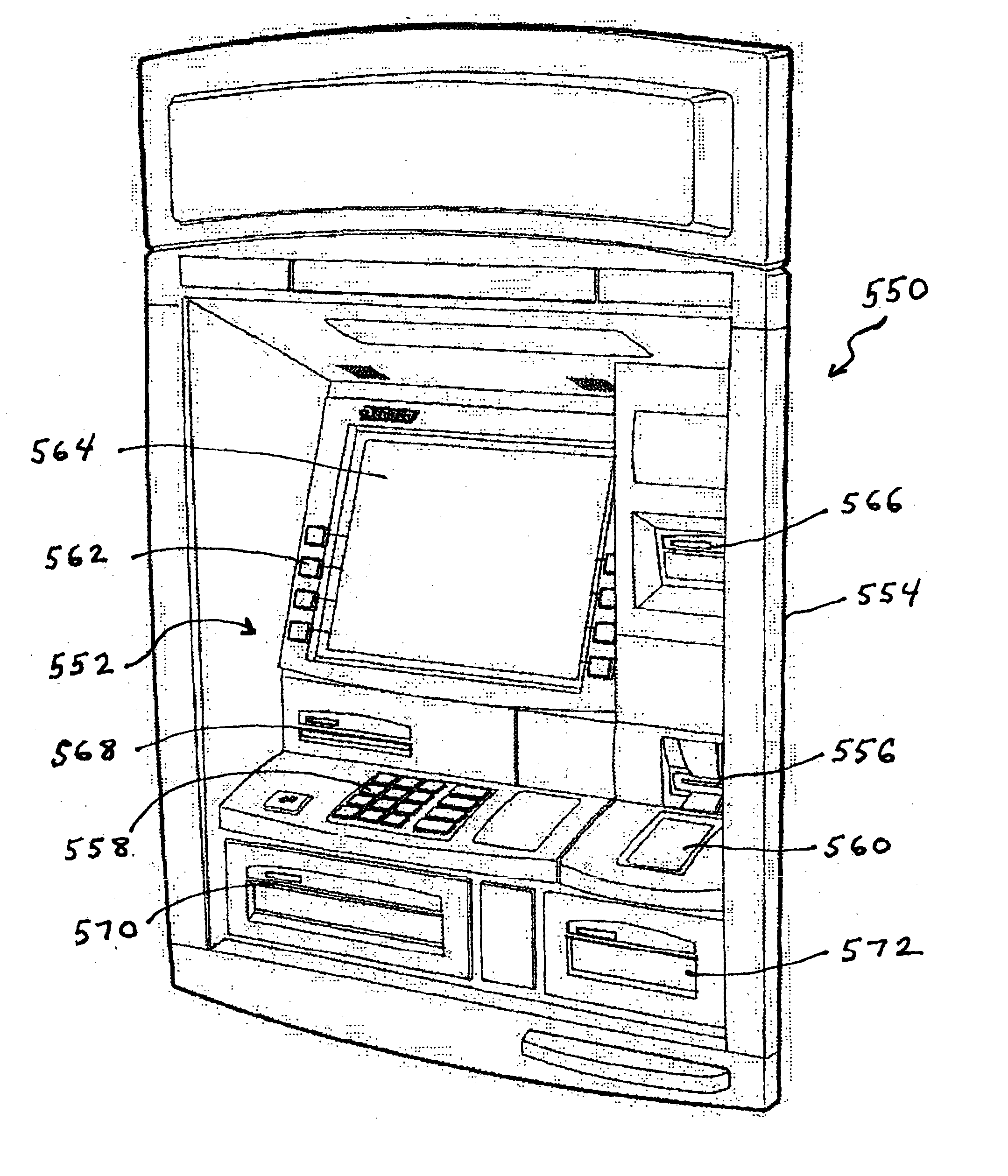

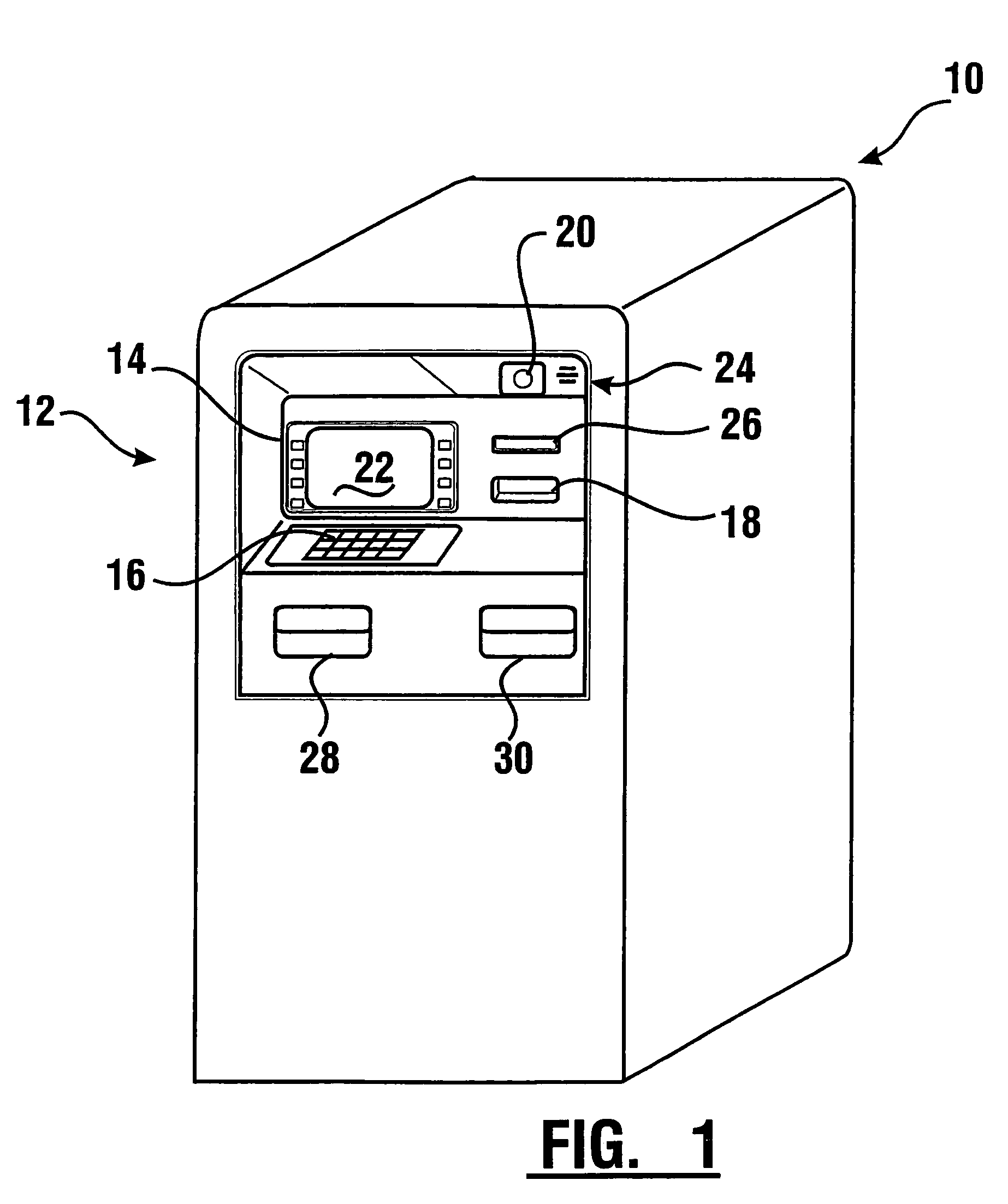

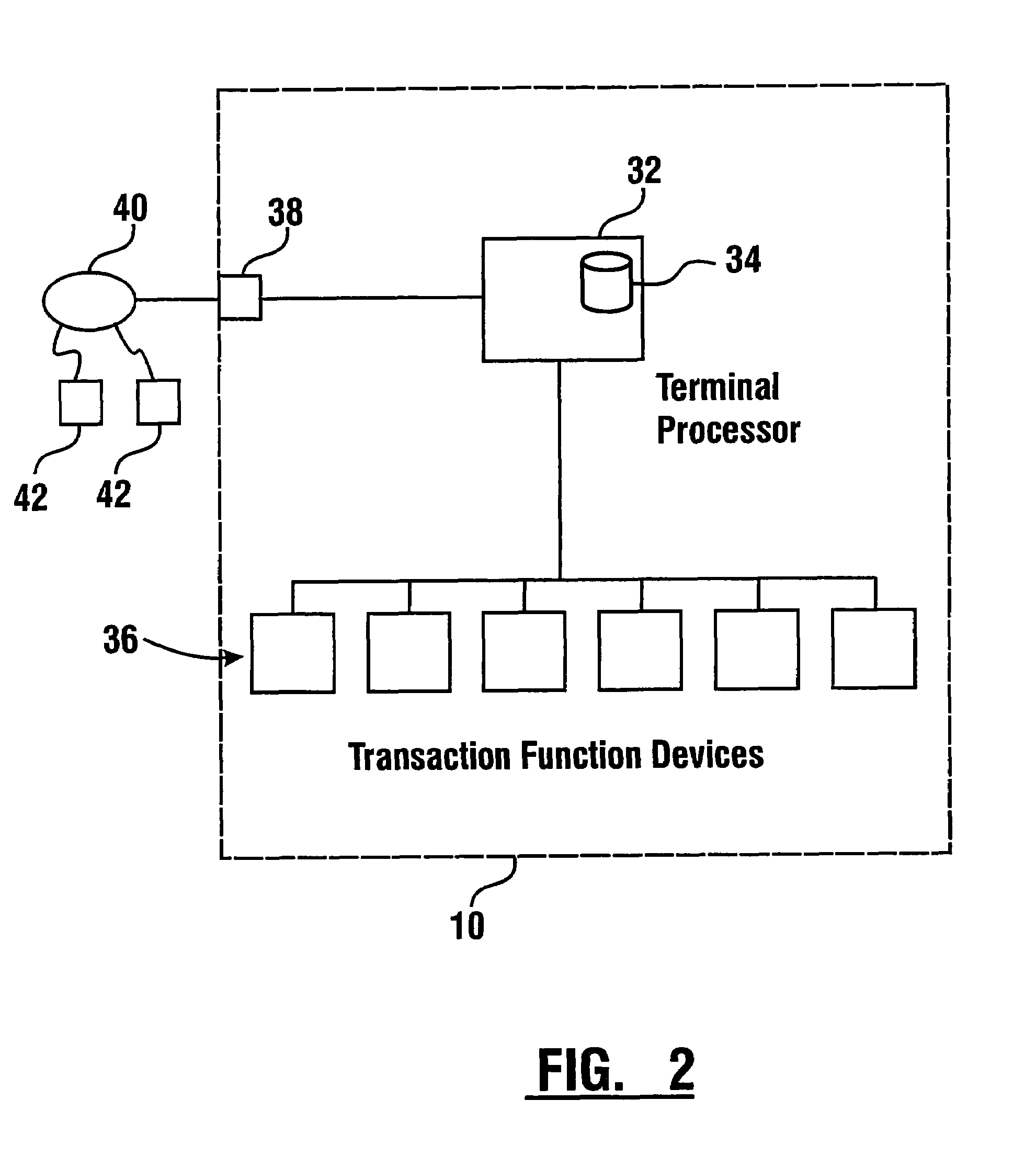

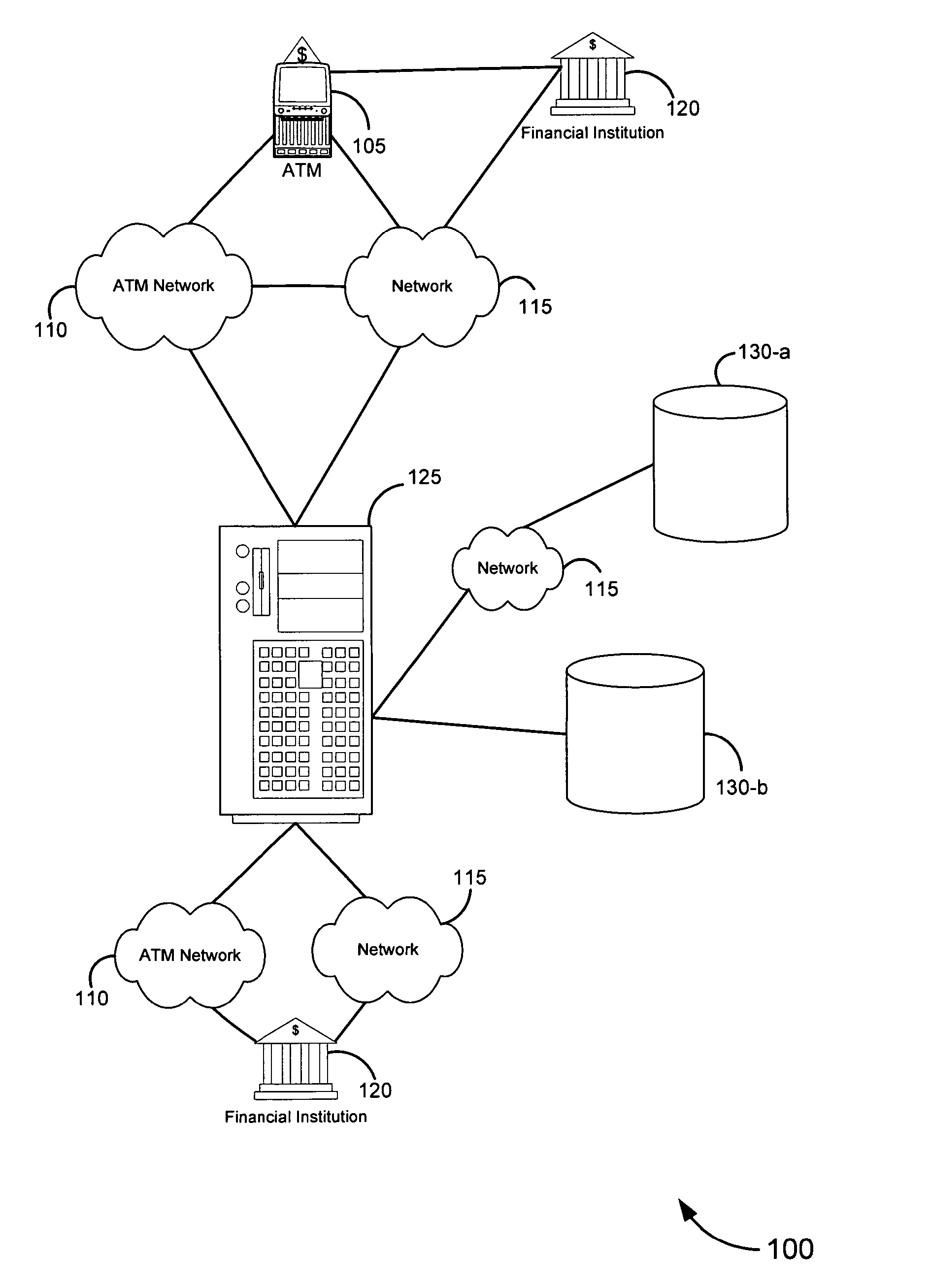

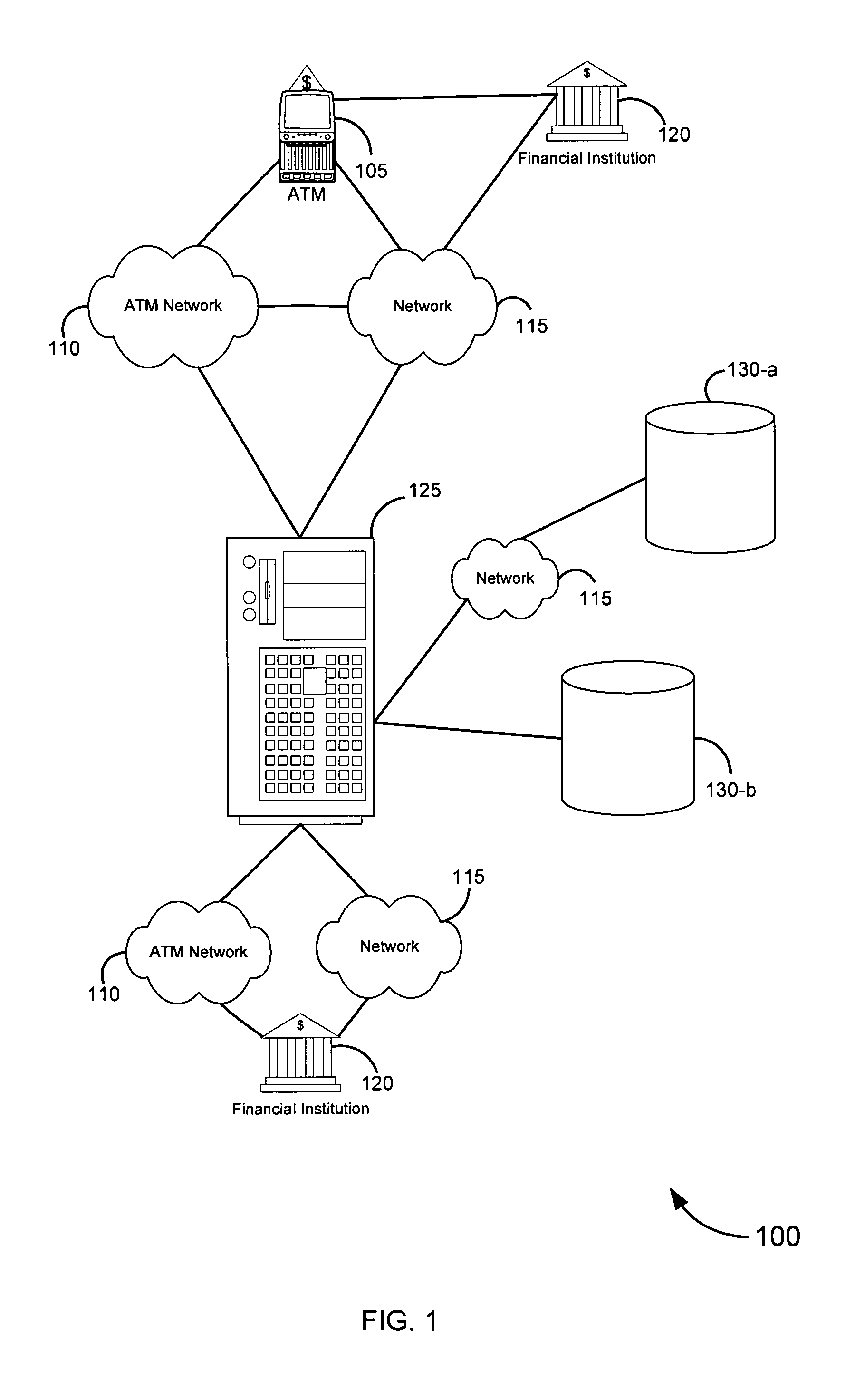

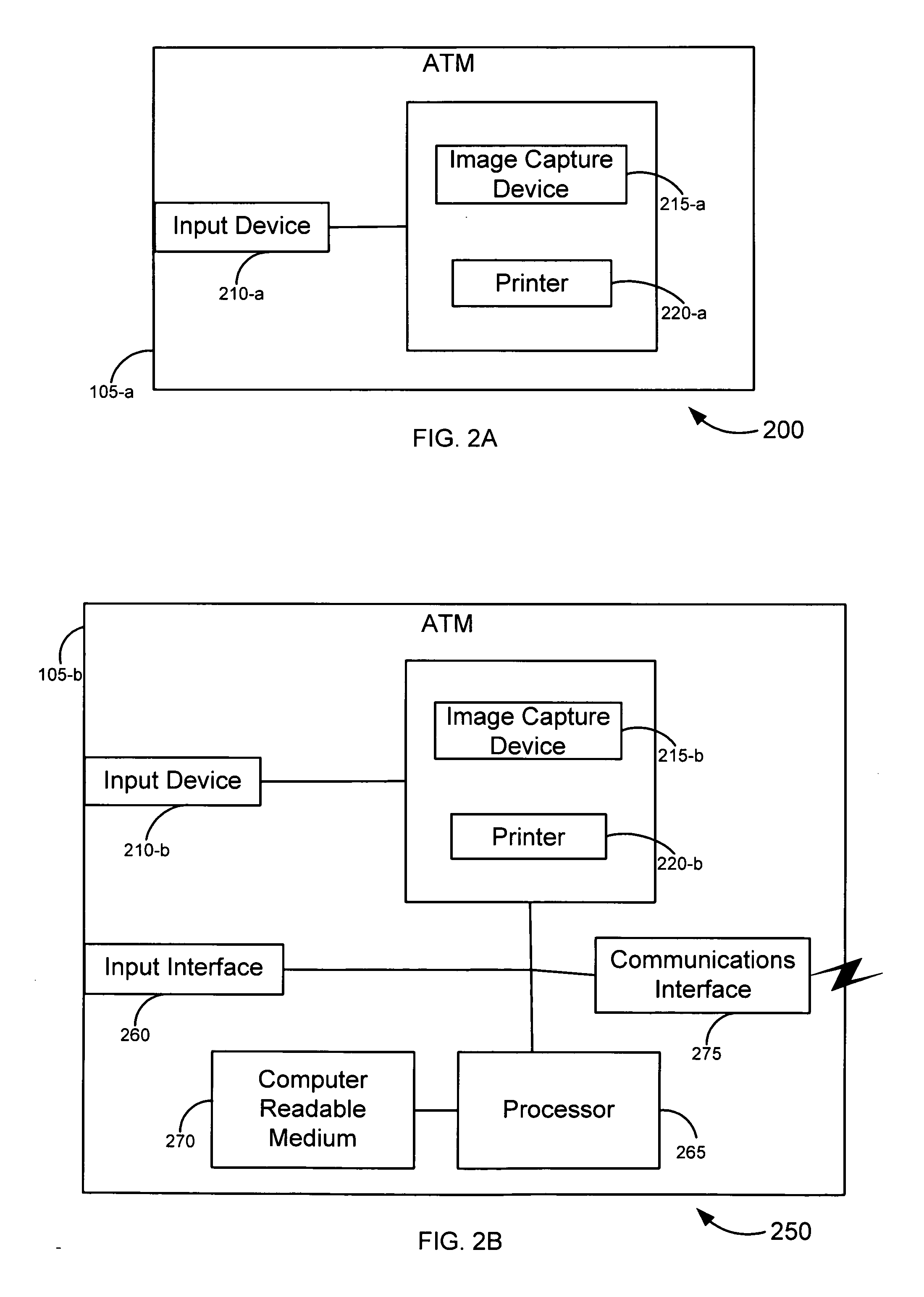

Automated banking machine system and method

InactiveUS20030217005A1Good user interfaceFunction increaseBuying/selling/leasing transactionsSpecific program execution arrangementsEmail addressCheque

A system and method of providing an electronic transaction receipt from a cash dispensing ATM. A bank host computer is operable to submit the receipt to a system address of record with the bank. The address of record corresponds to an e-mail address, phone number or other address associated with an account involved in the transaction. The receipt may include an image or images associated with the transaction. Thus, a user of an ATM is able to receive an electronic receipt corresponding to the ATM transaction. The system may also operate to image deposited checks deposited at an ATM. Copies of the imaged checks and other information can be electronically sent to a maker, payee, a clearinghouse or banks involved with the transaction. The system may also operate to provide the user with blank checks in hard copy or virtual checks for transactions.

Owner:DIEBOLD NIXDORF

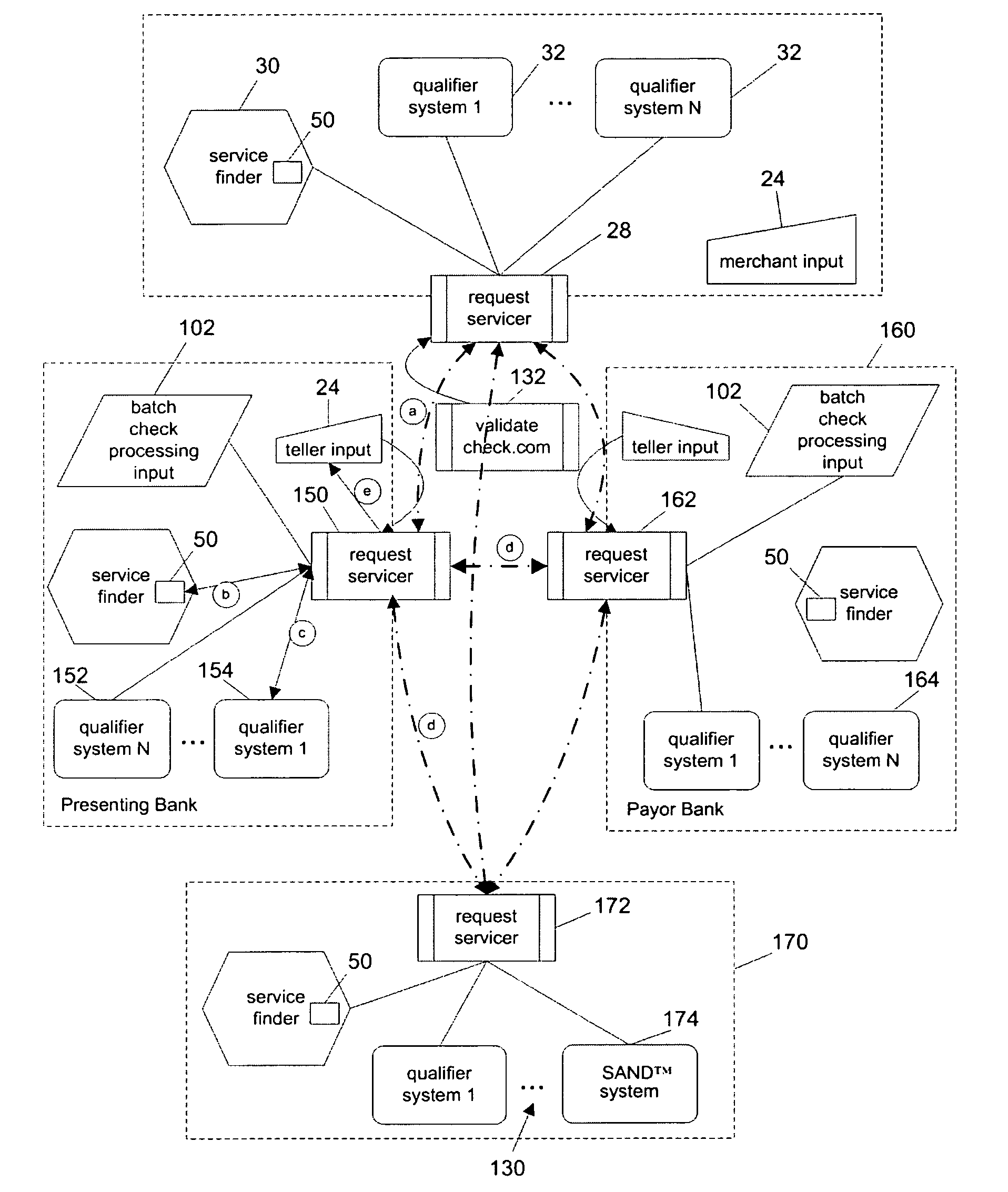

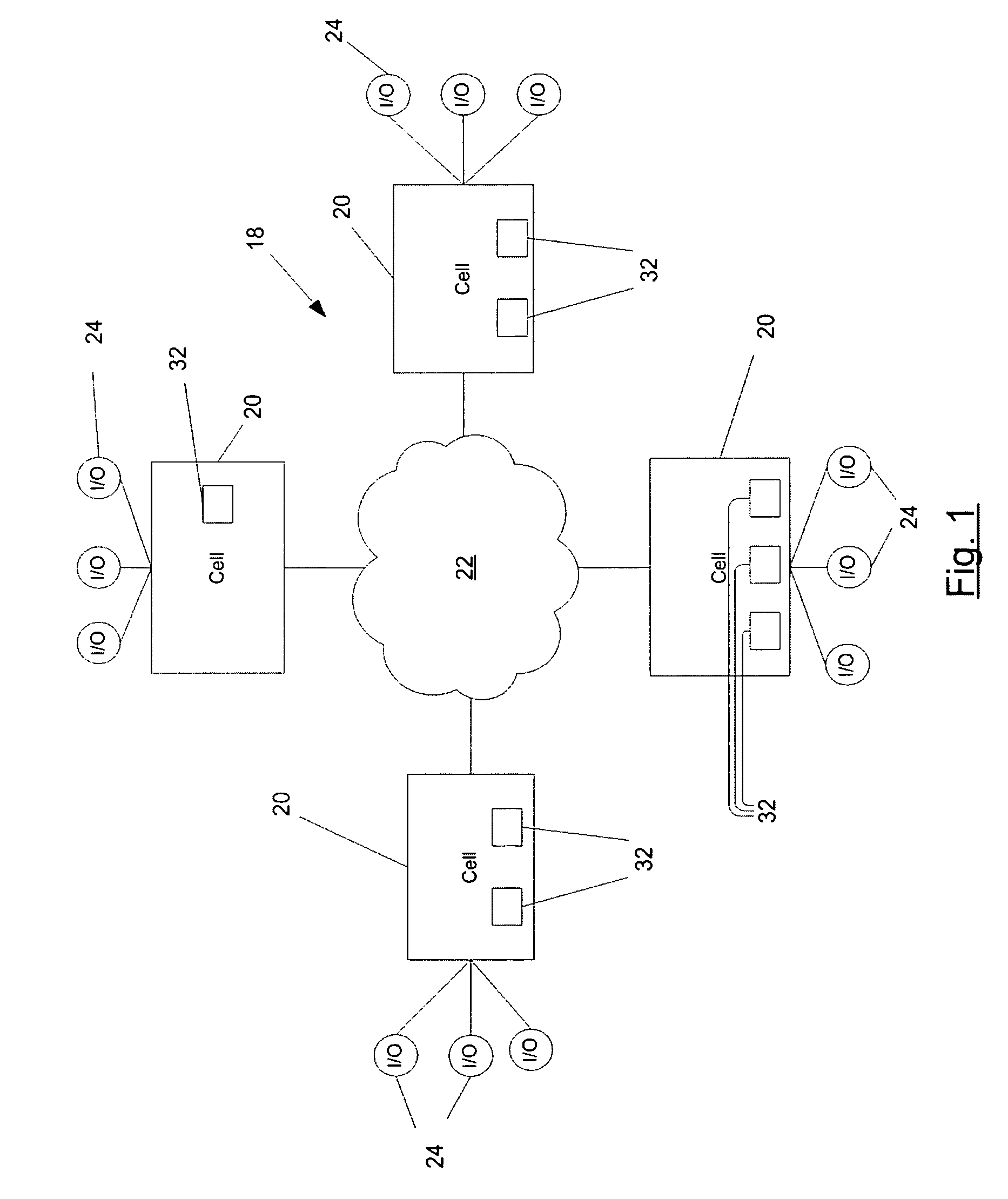

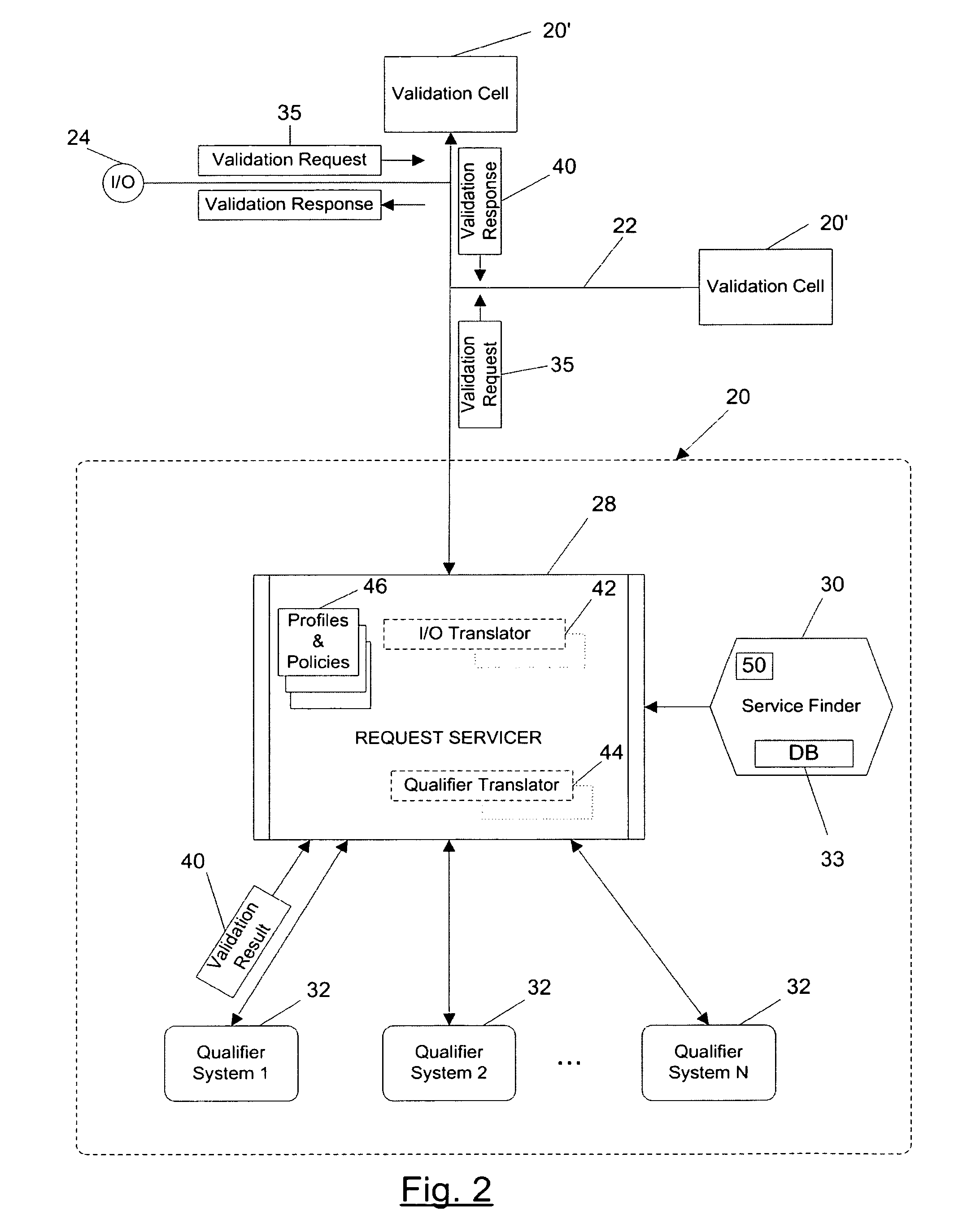

Payment validation network

ActiveUS7004382B2Easy to analyzeReduce riskComplete banking machinesSpecial service provision for substationPaymentTransaction data

A payment validation network having network of payment validation cells, each of which includes: one or more local qualifier systems for assessing the risk of loss in accepting a check; a service finder for identifying the scope of coverage provided by each of the local qualifier systems and for identifying the scope of coverage provided by other cells; and one or more input / output (I / O) sources for obtaining transaction data associated with a check at a point of presentment. The request servicer interfaces with the I / O sources, service finder and the qualifier systems in order to (i) receive transaction data from an I / O source in connection with the check, including the routing / transit number, (ii) maintain a user profile for the I / O source, (iii) consult the service finder to identify which local qualifier systems cover the routing / transit (R / T) number associated with the check, (iv) transmit a payment validation request to the identified local qualifier systems and at least one other remote request servicer in accordance with the user profile, (v) receive one or more validation results from local qualifier systems or remote request servicers, and (vi) process said results to provide a homogeneous validation assessment to the requesting I / O source.

Owner:ADVANCED SOFTWARE DESIGN

Customer-controlled instant-response anti-fraud/anti-identity theft devices (with true-personal identity verification), method and systems for secured global applications in personal/business e-banking, e-commerce, e-medical/health insurance checker, e-education/research/invention, e-disaster advisor, e-immigration, e-airport/aircraft security, e-military/e-law enforcement, with or without NFC component and system, with cellular/satellite phone/internet/multi-media functions

All-in-one wireless mobile telecommunication devices, methods and systems providing greater customer-control, instant-response anti-fraud / anti-identity theft protections with instant alarm, messaging and secured true-personal identity verifications for numerous registered customers / users, with biometrics and PIN security, operating with manual, touch-screen and / or voice-controlled commands, achieving secured rapid personal / business e-banking, e-commerce, accurate transactional monetary control and management, having interactive audio-visual alarm / reminder preventing fraudulent usage of legitimate physical and / or virtual credit / debit cards, with checks anti-forgery means, curtailing medical / health / insurance frauds / identity thefts, having integrated cellular and / or satellite telephonic / internet and multi-media means, equipped with language translations, GPS navigation with transactions tagging, currency converters, with or without NFC components, minimizing potential airport risks / mishaps, providing instant aid against school bullying, kidnapping, car-napping and other crimes, applicable for secured military / immigration / law enforcements, providing guided warning / rescue during emergencies and disasters.

Owner:VILLA REAL ANTONY EUCLID C

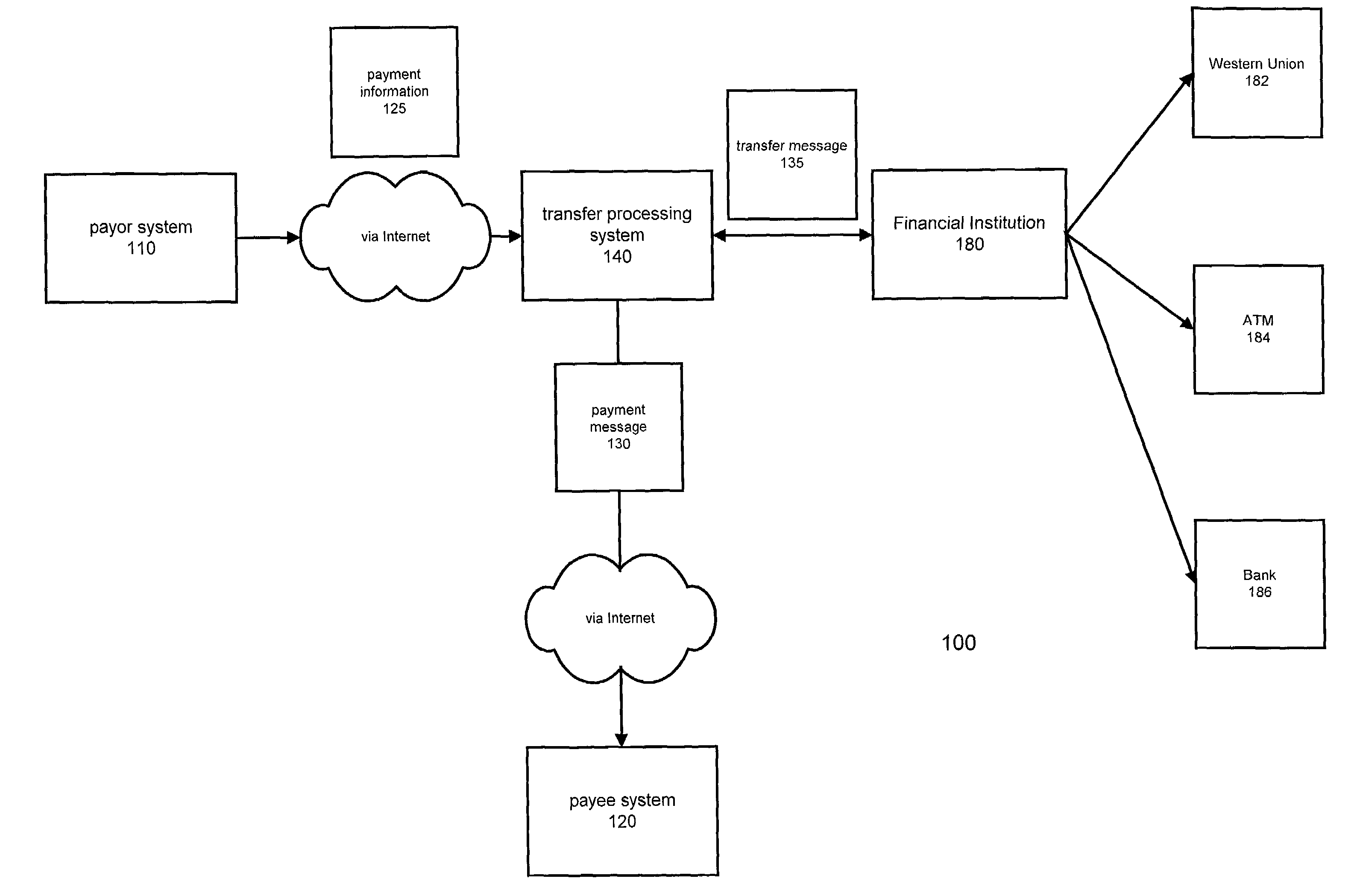

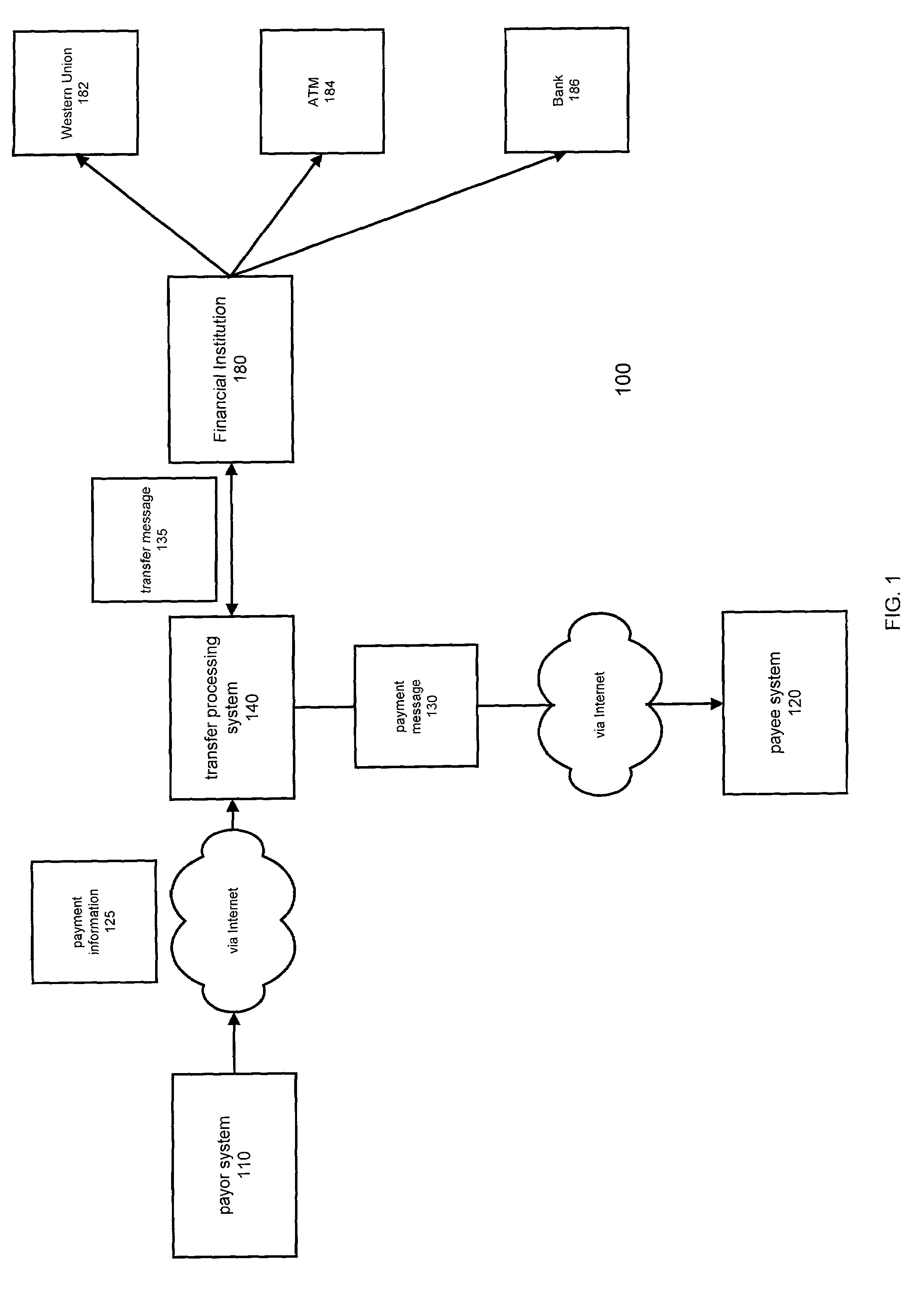

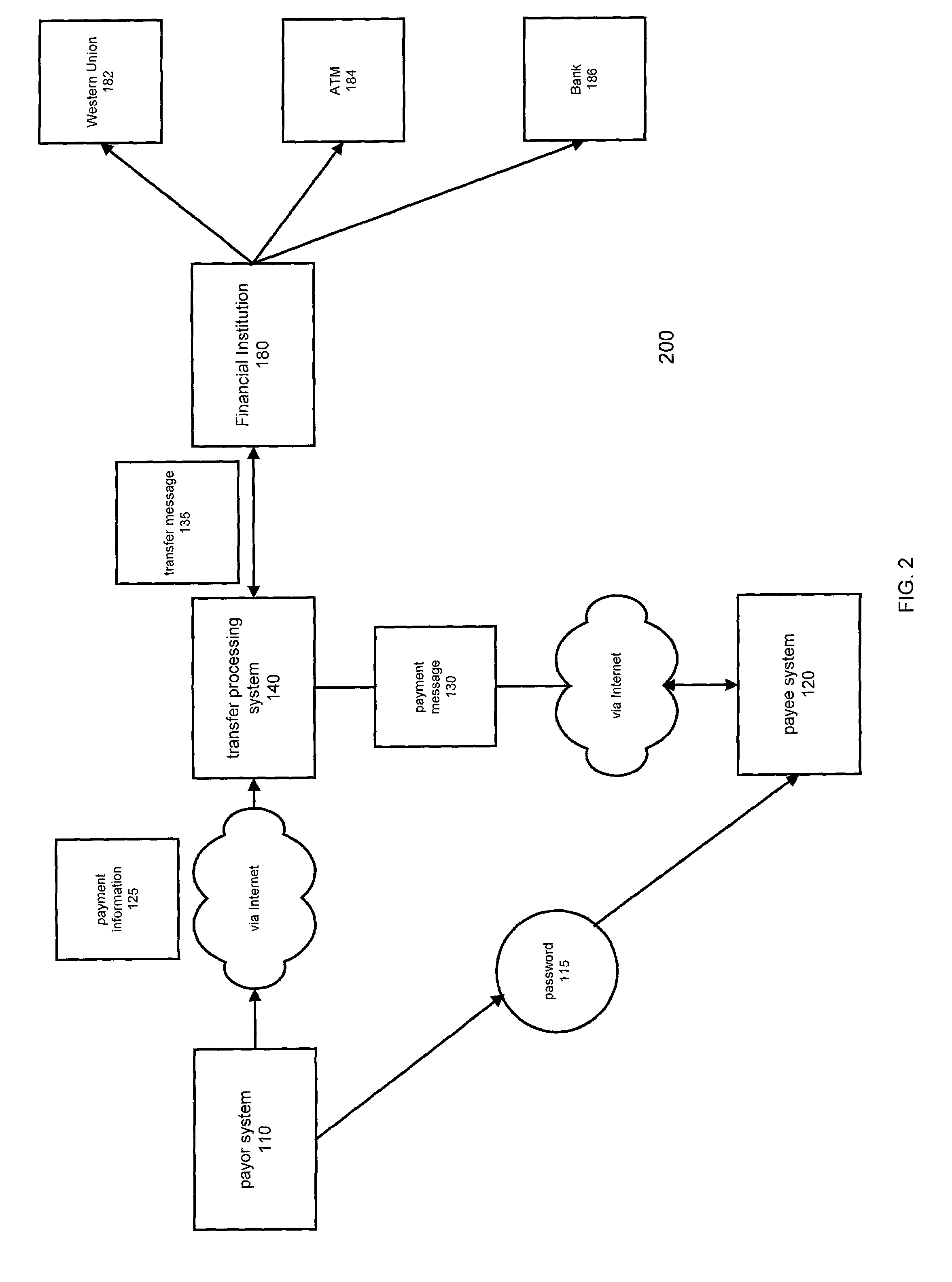

Method and system for transferring electronic funds

InactiveUS7644037B1Promote commercial linkQuick applicationComplete banking machinesFinanceCredit cardThe Internet

A method and system for transferring electronic funds over the Internet wherein a sender provides payment information to a transfer processing system. The sender may choose from a plurality of different types of funds transfer, such as wire transfer, Western Union money transfer, various types of checks, and transfers to ATM debit / credit cards. The transfer processing system sends an electronic payment message to a recipient indicating the transfer of funds and a transfer message to a financial institution providing instructions to debit the sender's account and make those funds available to the recipient. If the recipient has an account with a financial institution that is affiliated with the transfer processing system of the present invention, the funds are credited to the recipient's account wherein the payment message serves as a confirmation message. If the recipient does not have such an account, the recipient may access the transfer processing system to access the funds made available by the system wherein the payment message serves as a payment availability message.

Owner:BLACKBIRD TECH

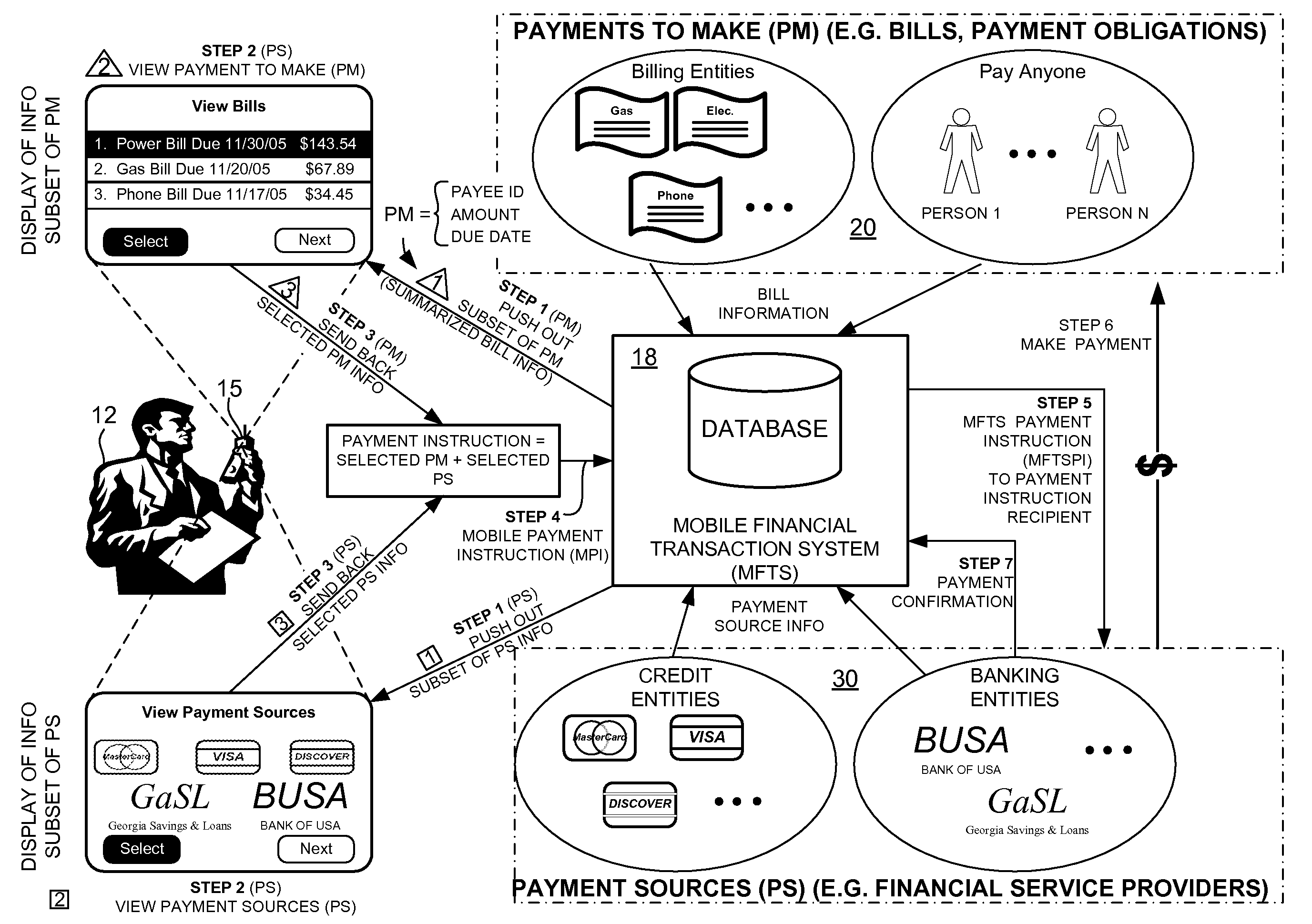

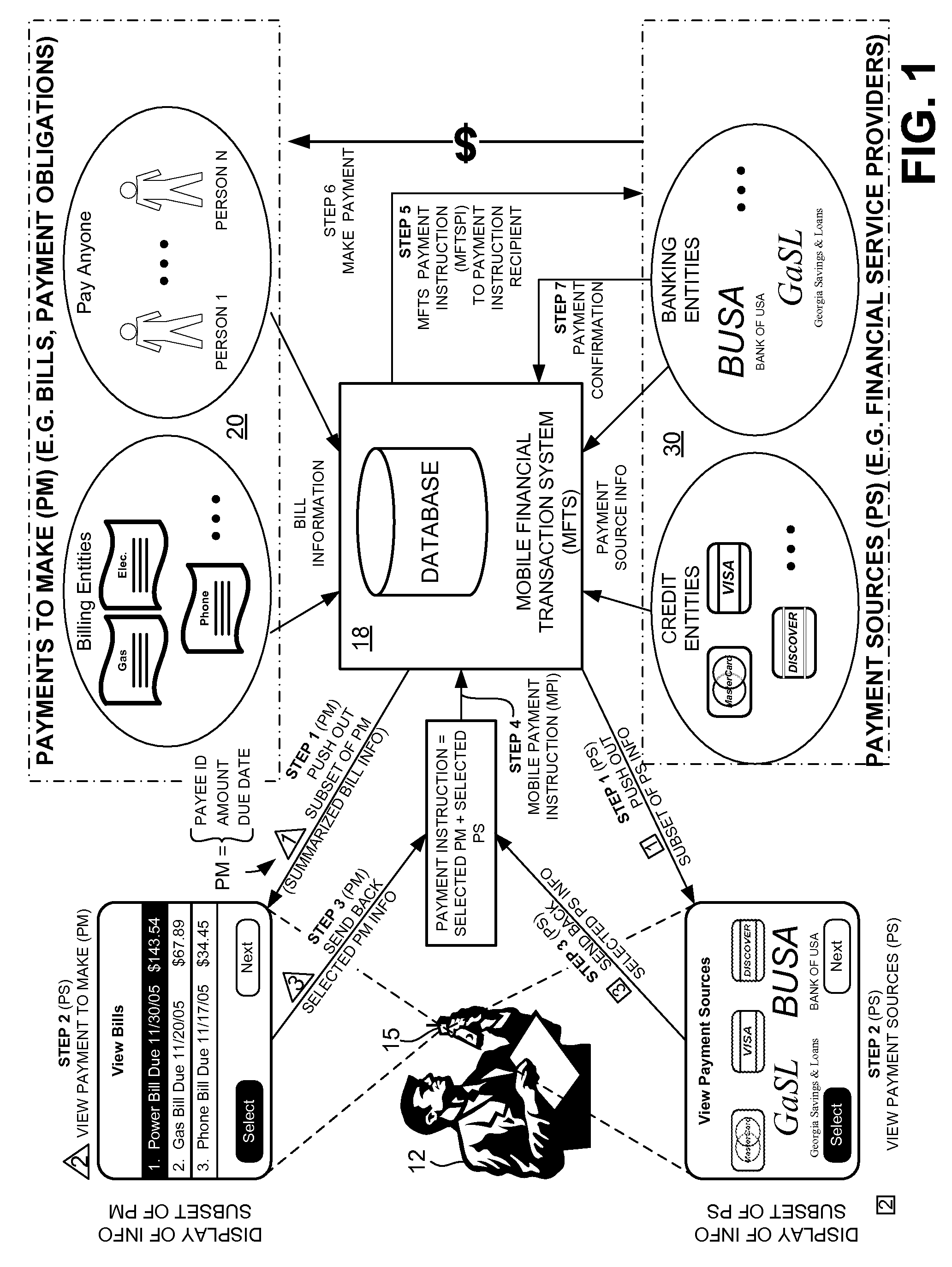

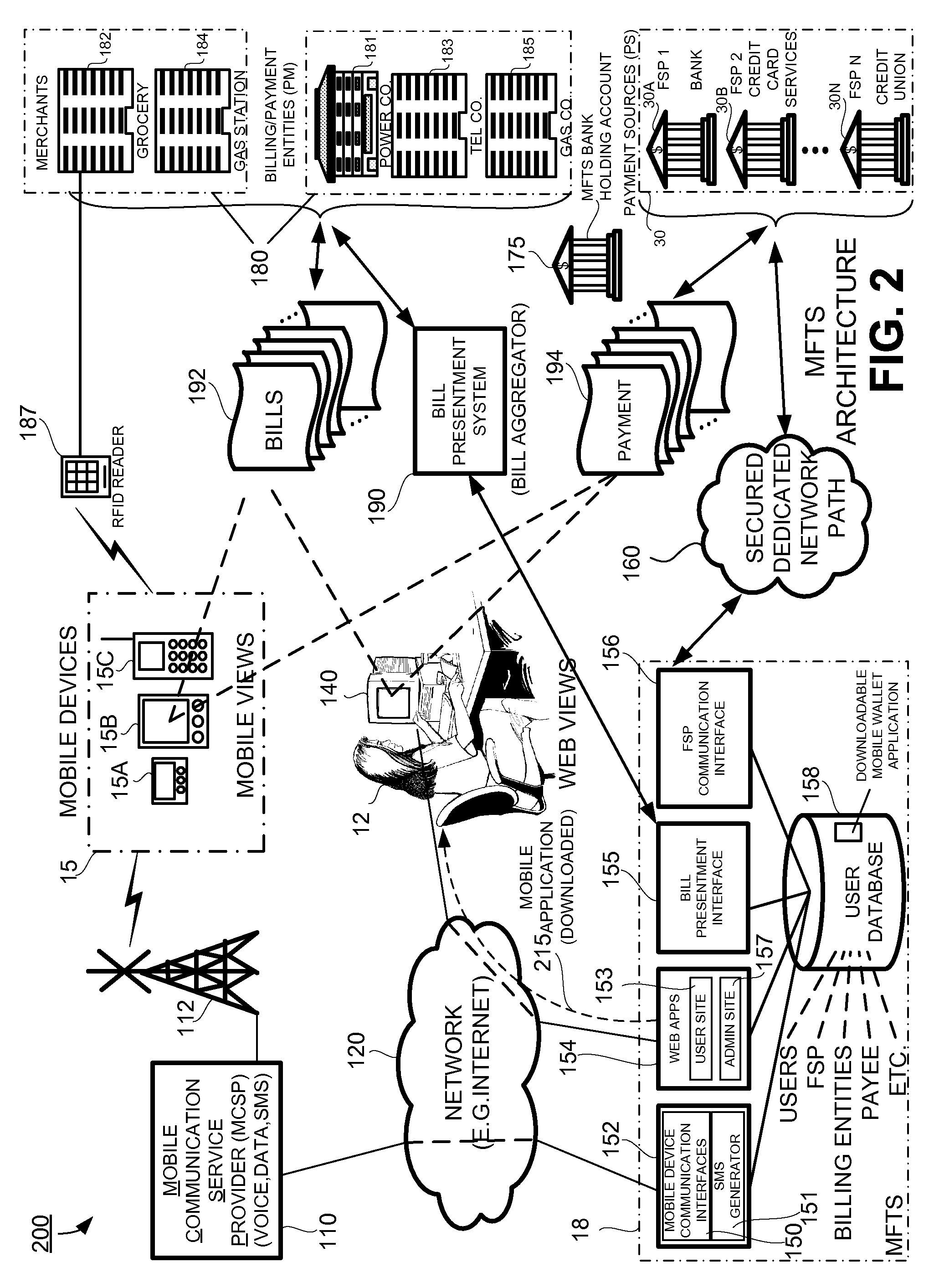

Methods and Systems For Making a Payment Via a Paper Check in a Mobile Environment

InactiveUS20080010204A1Unprecedented convenienceUnprecedented flexibilityAcutation objectsFinanceChequeFinancial transaction

Methods and systems for making a financial payment to a payee via a paper check utilizing a mobile device such as a mobile telephone (cellphone) or wireless connected personal digital assistant (PDA). The mobile device communicates wirelessly with a mobile financial transaction system (MFTS) that stores user information and transaction information. A user enters information via the mobile device identifying a payee and indicating a paper check payment method. The mobile device generates a mobile payment instruction that includes information corresponding to the identified payee and indicating a paper check payment method. The mobile payment instruction is wirelessly communicated to the MFTS. The MFTS generates an MFTS payment instruction to a payment instruction recipient that can issue a paper check. The MFTS communicates the MFTS payment instruction to the payment instruction recipient, which arranges for payment to the identified payee by printing and mailing of a paper check to the payee.

Owner:QUALCOMM INC

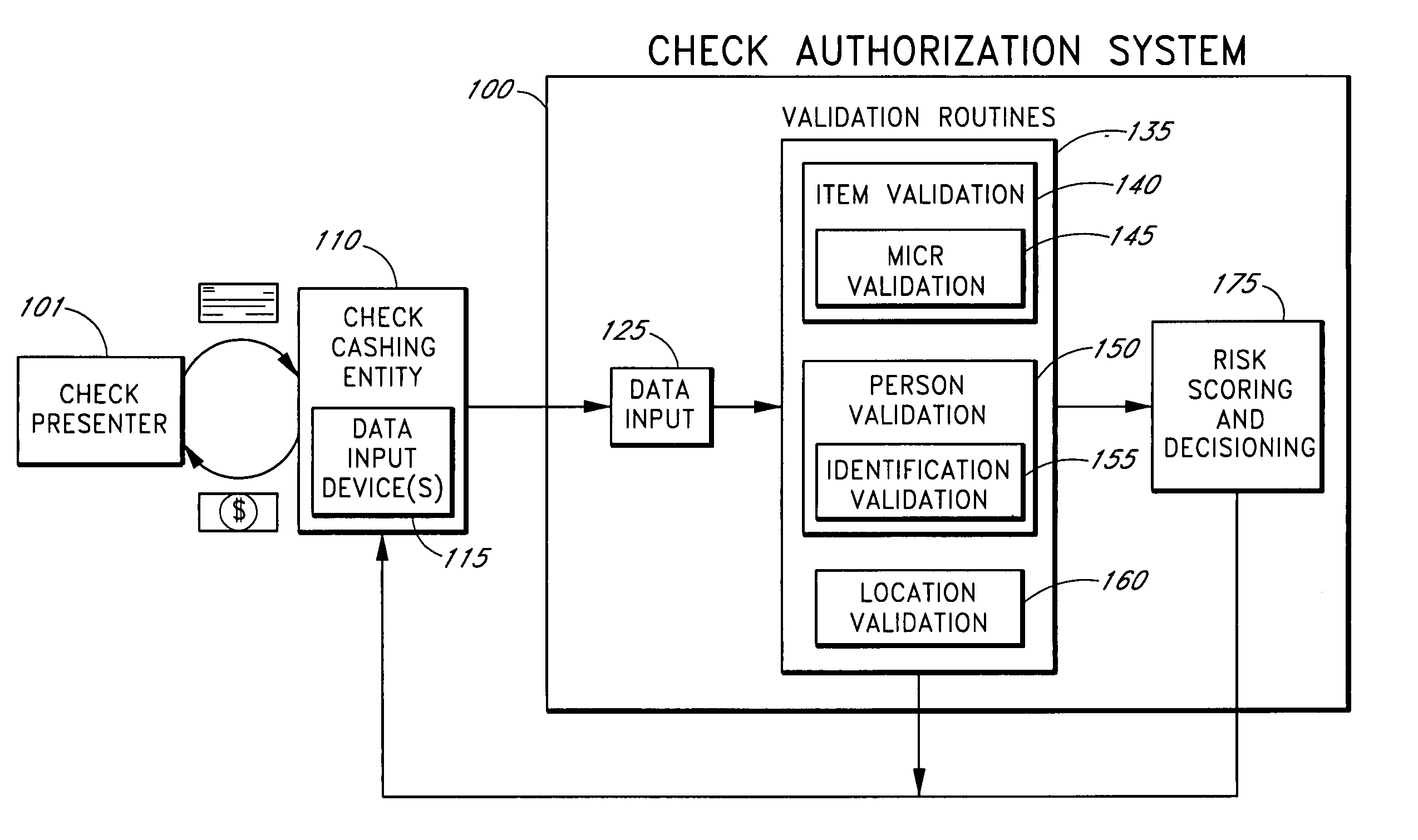

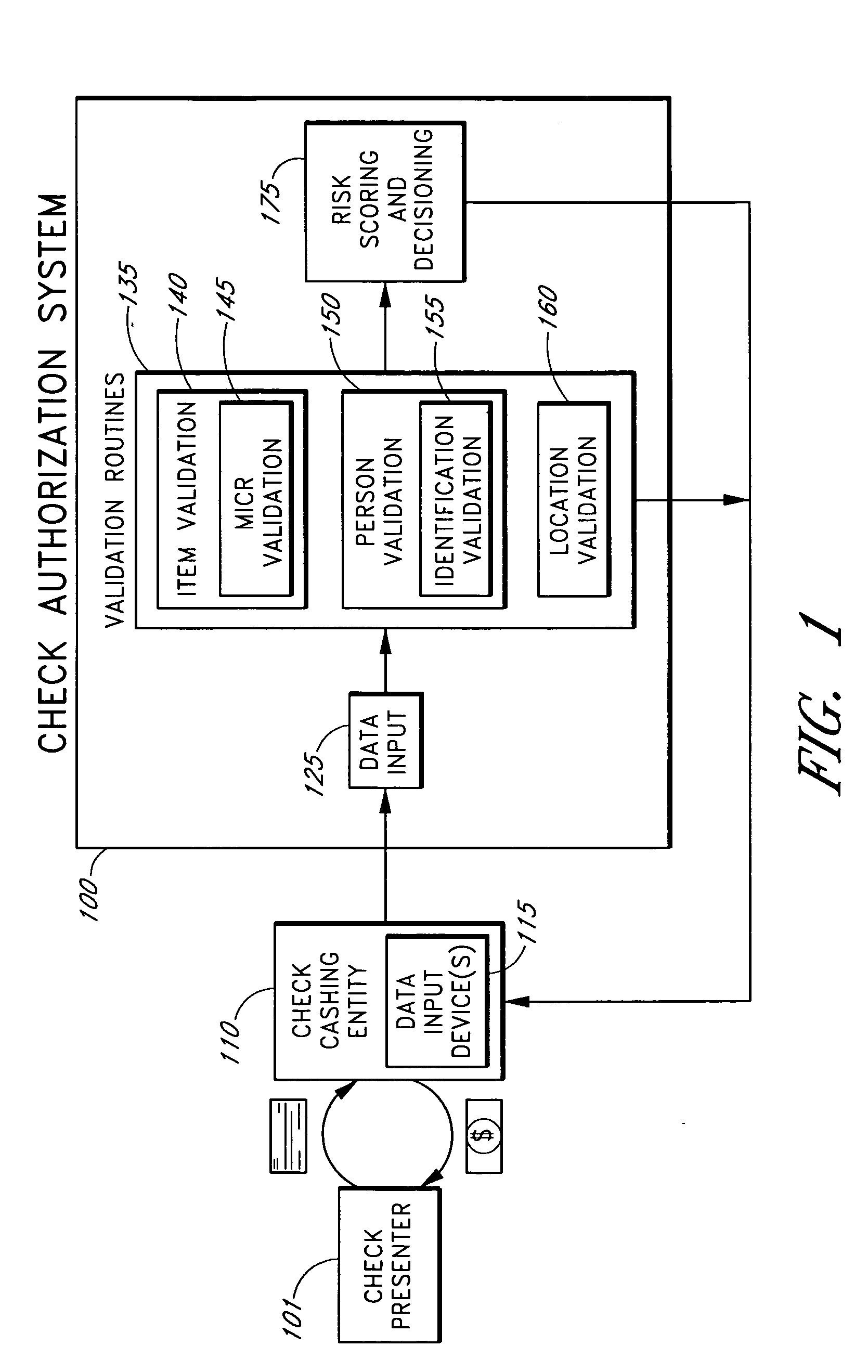

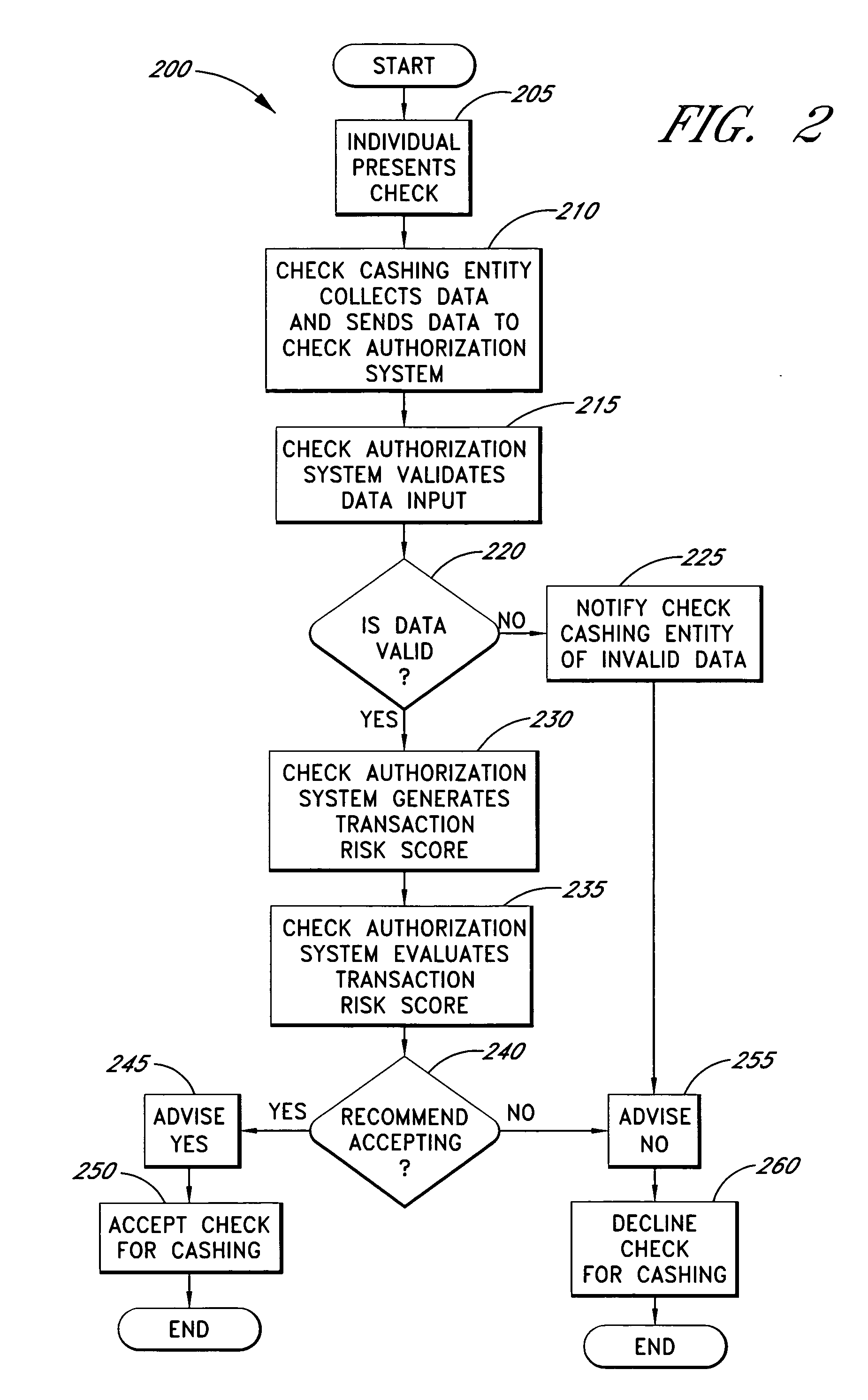

Systems and methods for obtaining authentication marks at a point of sale

InactiveUS20050125360A1Accurate descriptionSlow processPaper-money testing devicesPoint-of-sale network systemsBarcodeCheque

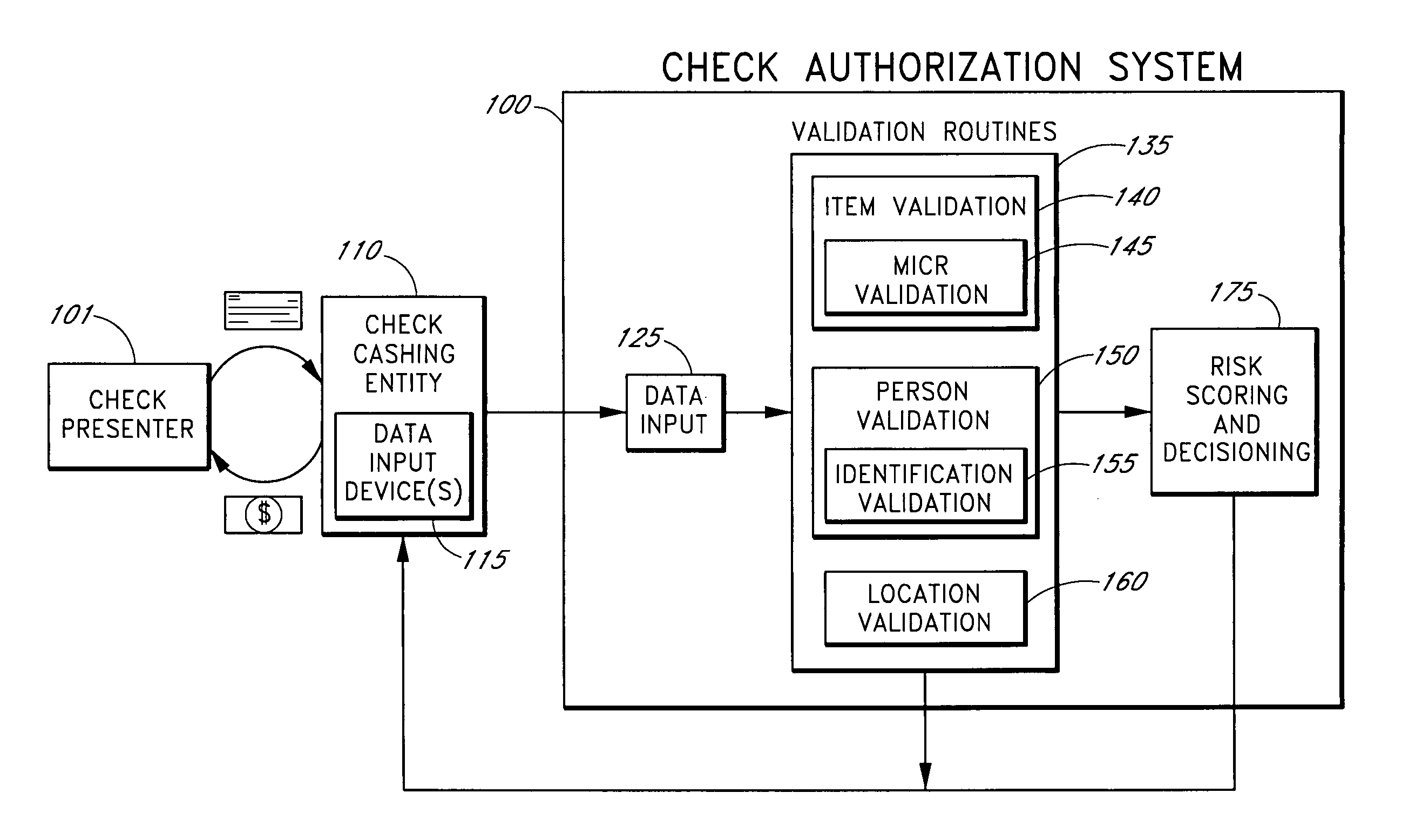

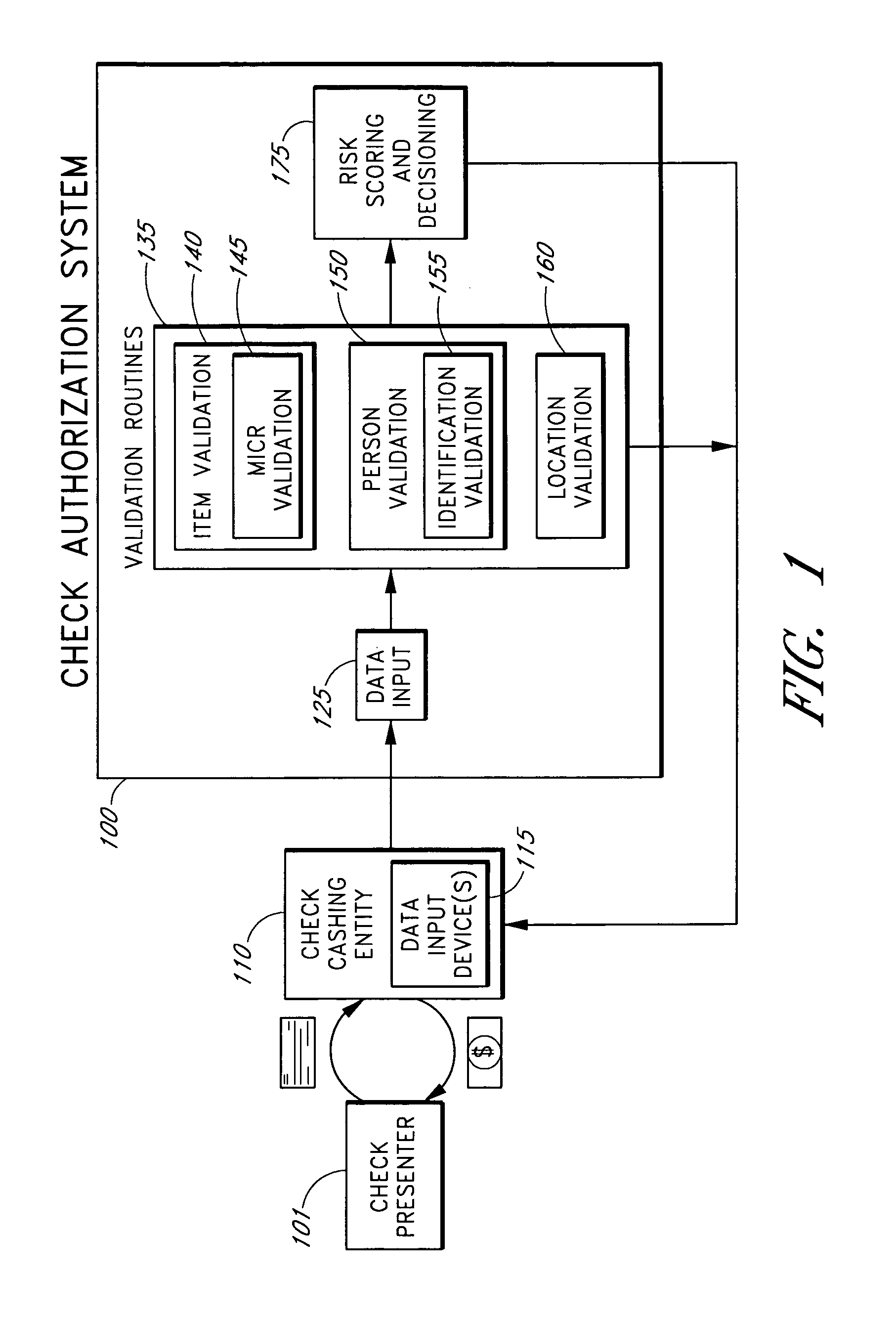

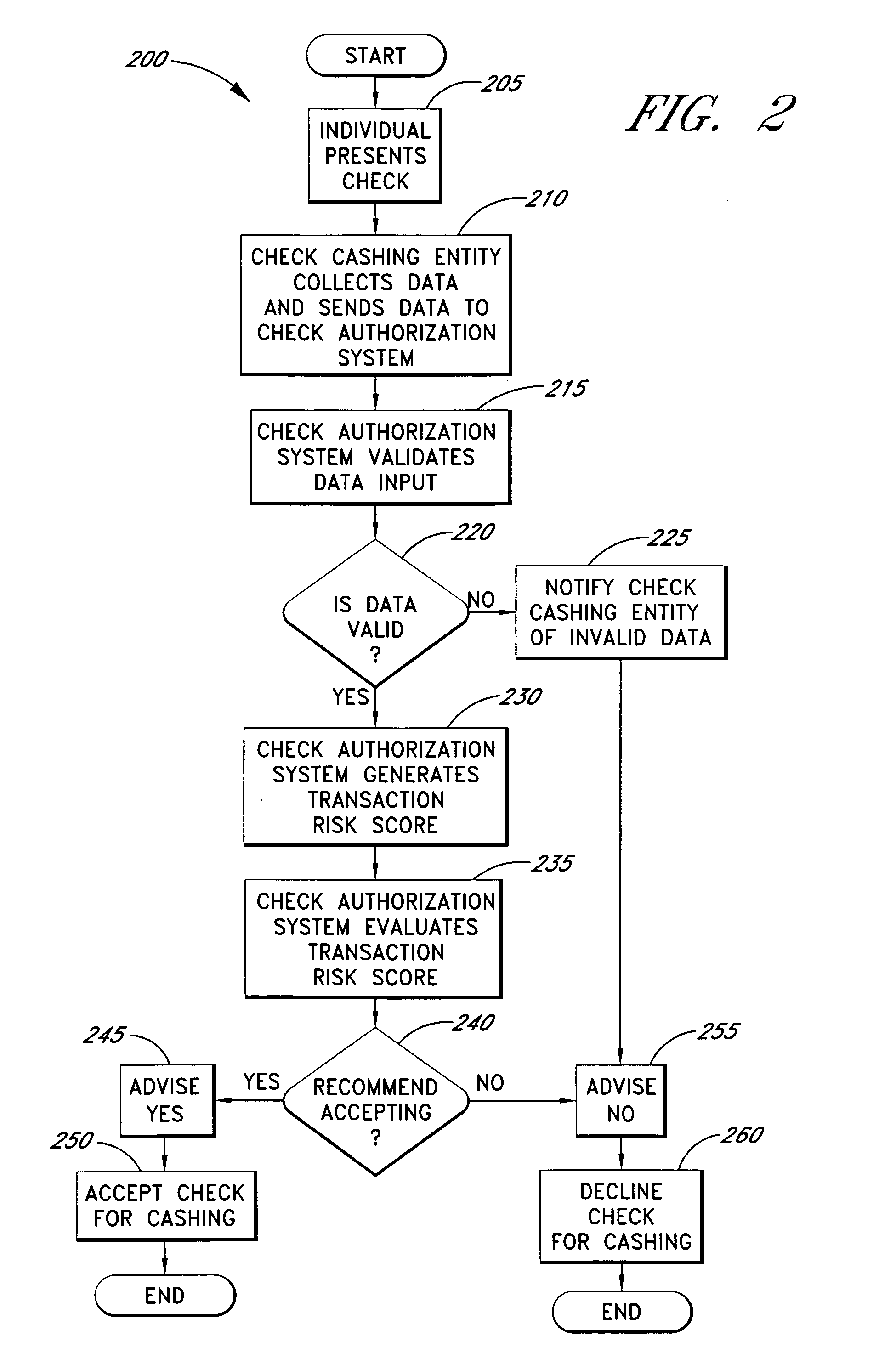

Systems and methods are described for using a point-of-sale device at a check-cashing entity to obtain information about one or more authenticating marks, such as watermarks, bar codes, background patterns, color schemes, insignia, security validation numbers, or the like, from a second-party check or other negotiable instrument presented for a proposed check-cashing transaction. In various embodiments, the authenticating mark information may be compared to stored information about expected configurations of authenticating marks as part of a risk assessment of the check. In various embodiments, the point-of-sale device transmits authenticating mark information to a check authorization system. The point-of-sale device may receive an accept / decline recommendation for the transaction from the check authorization system, based at least in part on the obtained authenticating mark information. The point-of-sale device may display a message about the recommendation to an operator of the device.

Owner:FIRST DATA

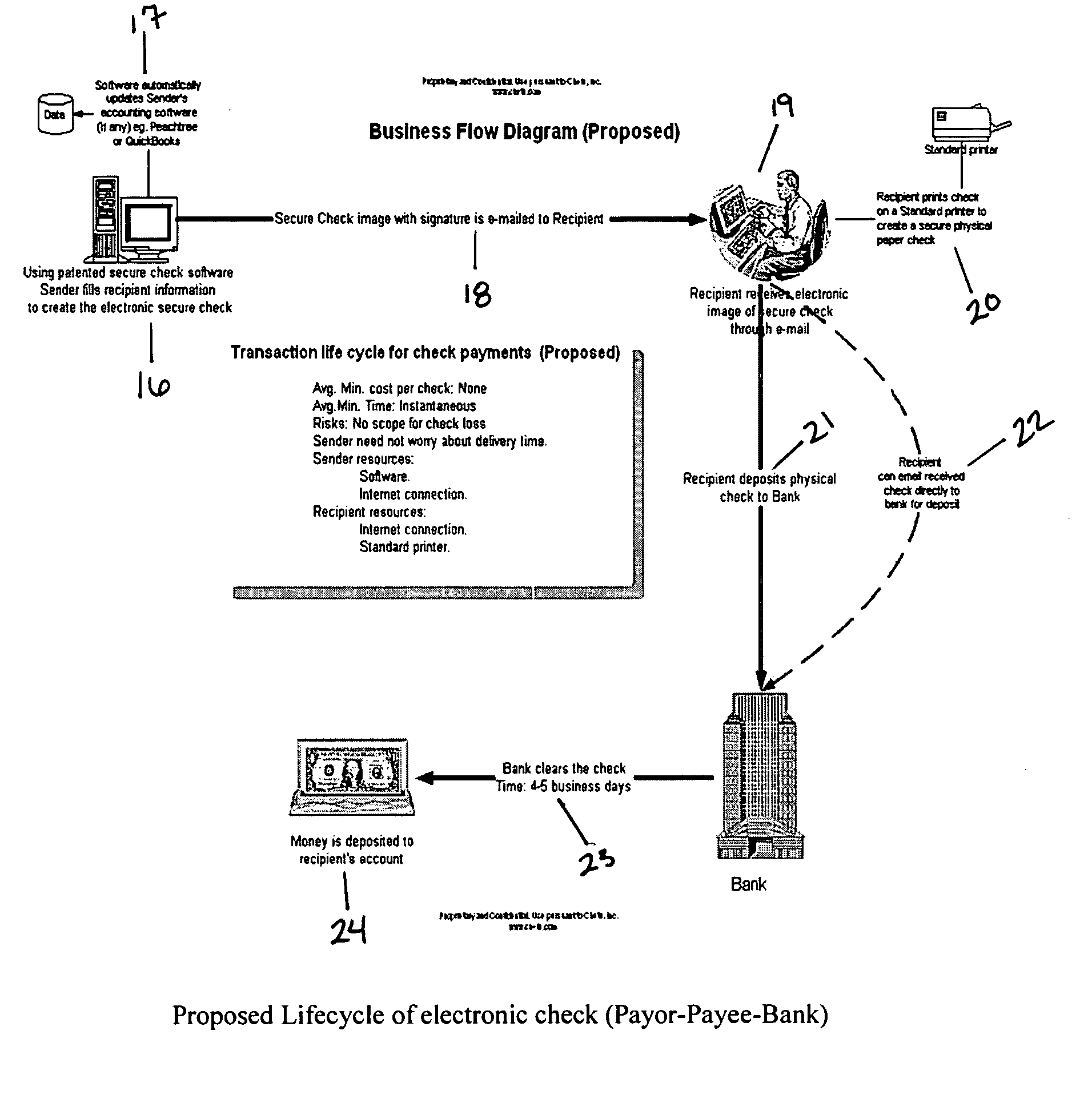

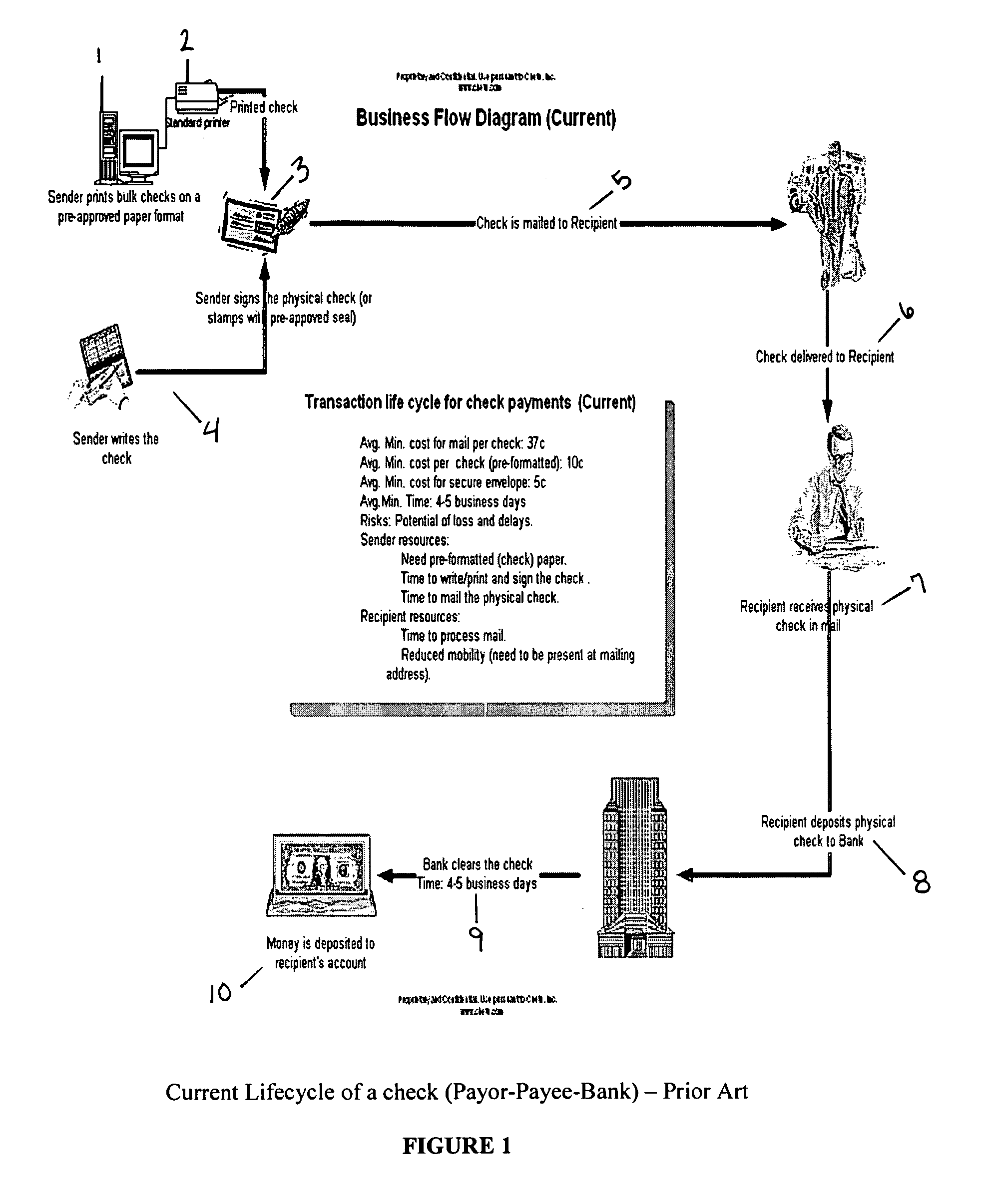

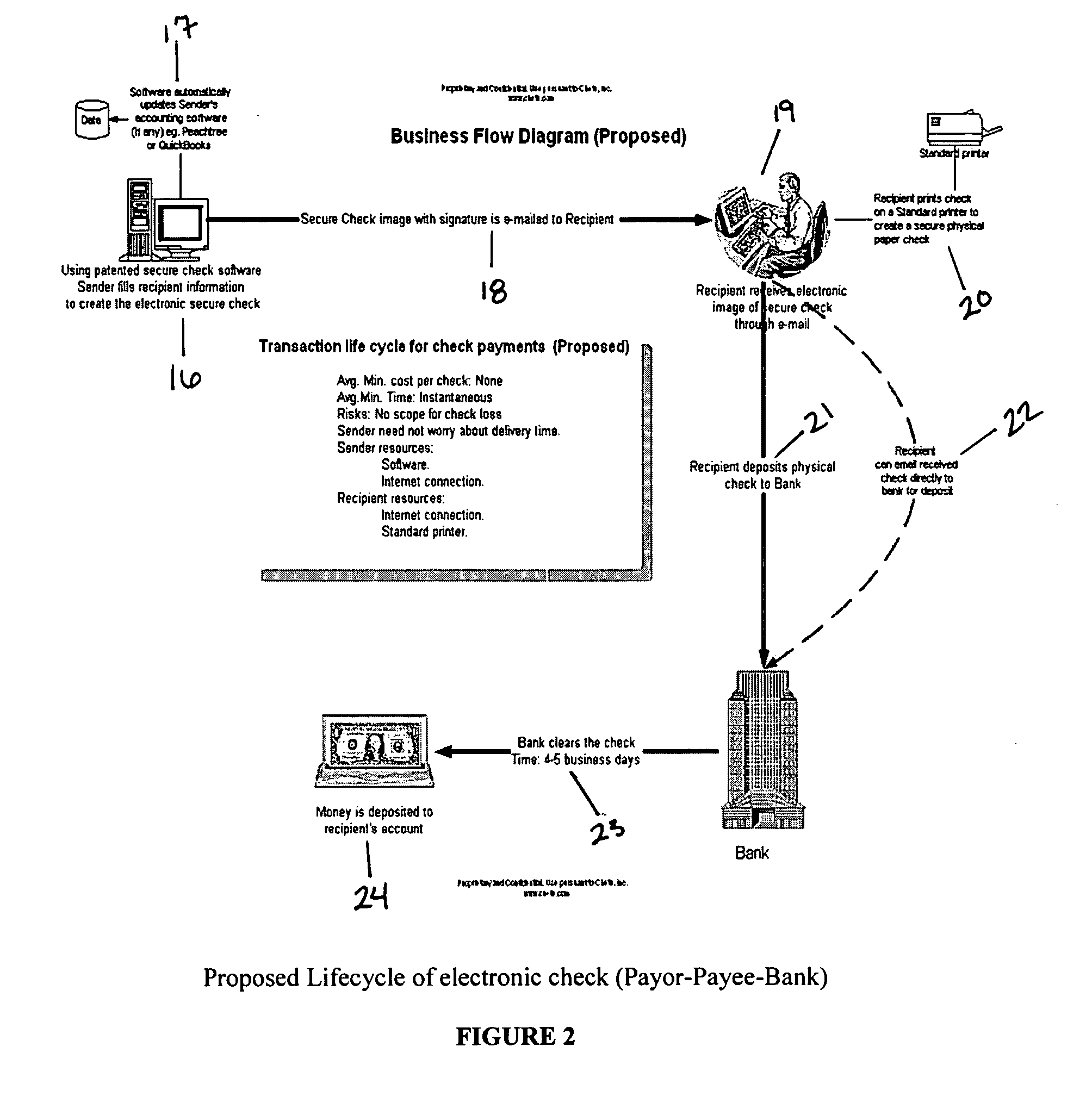

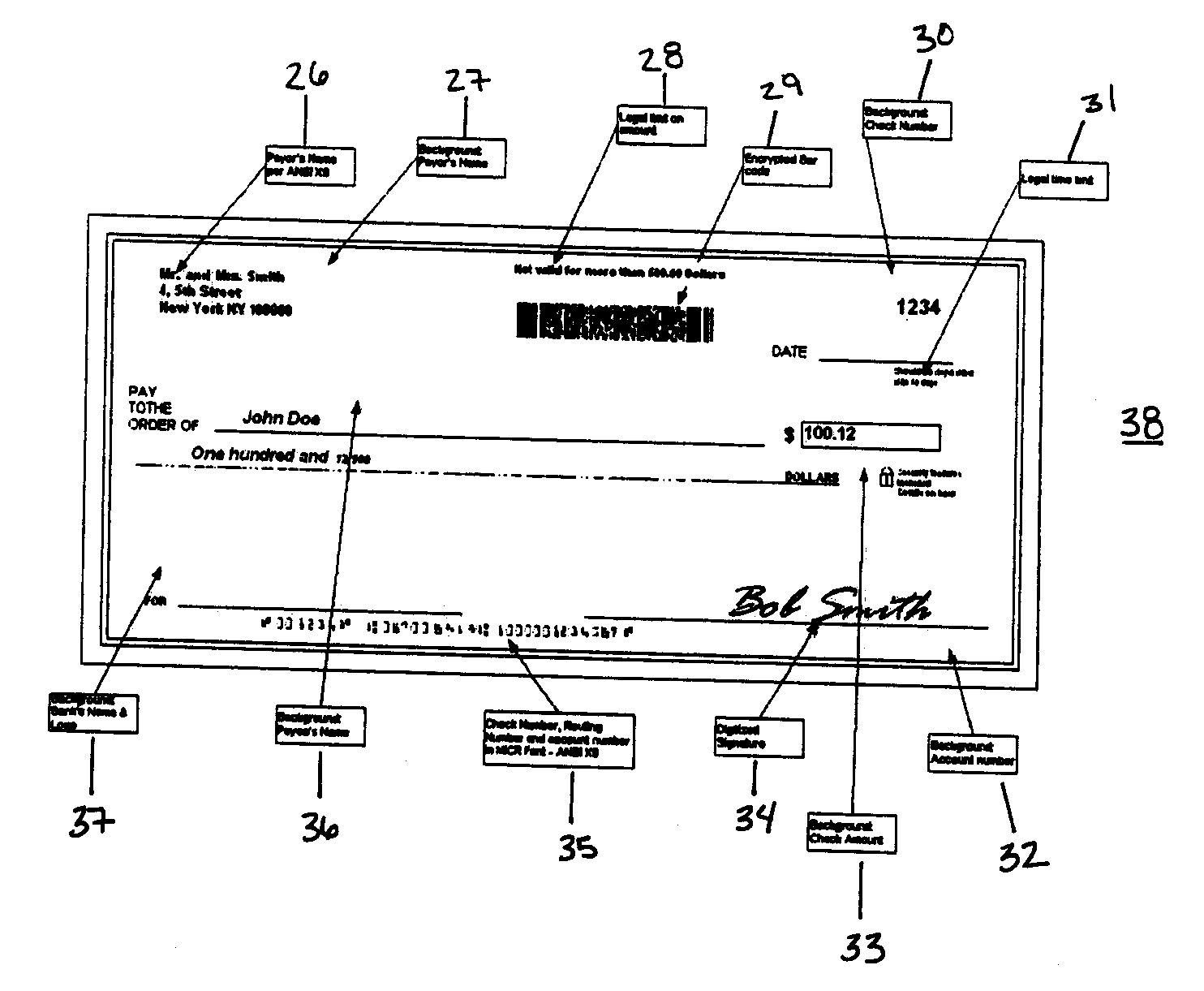

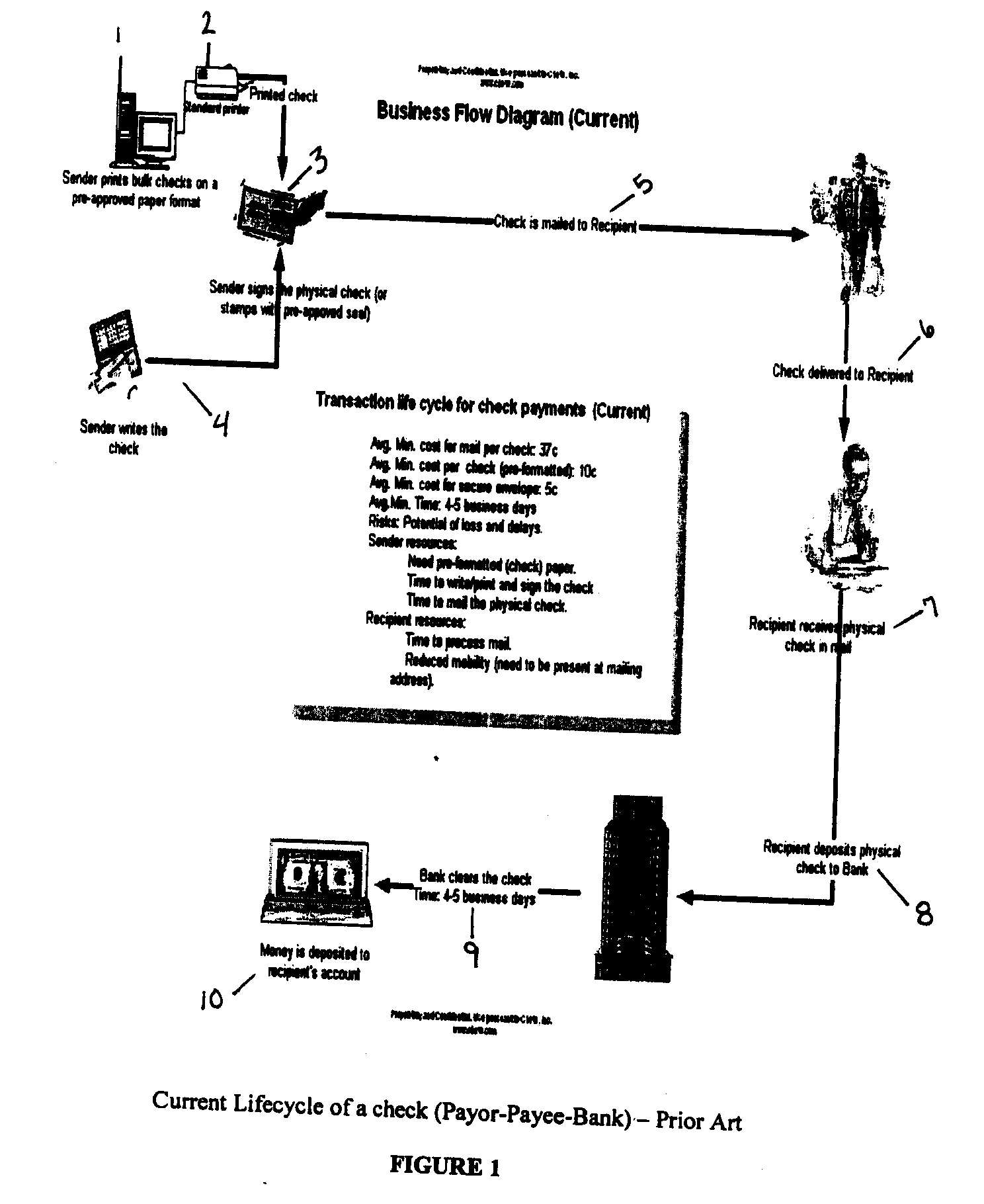

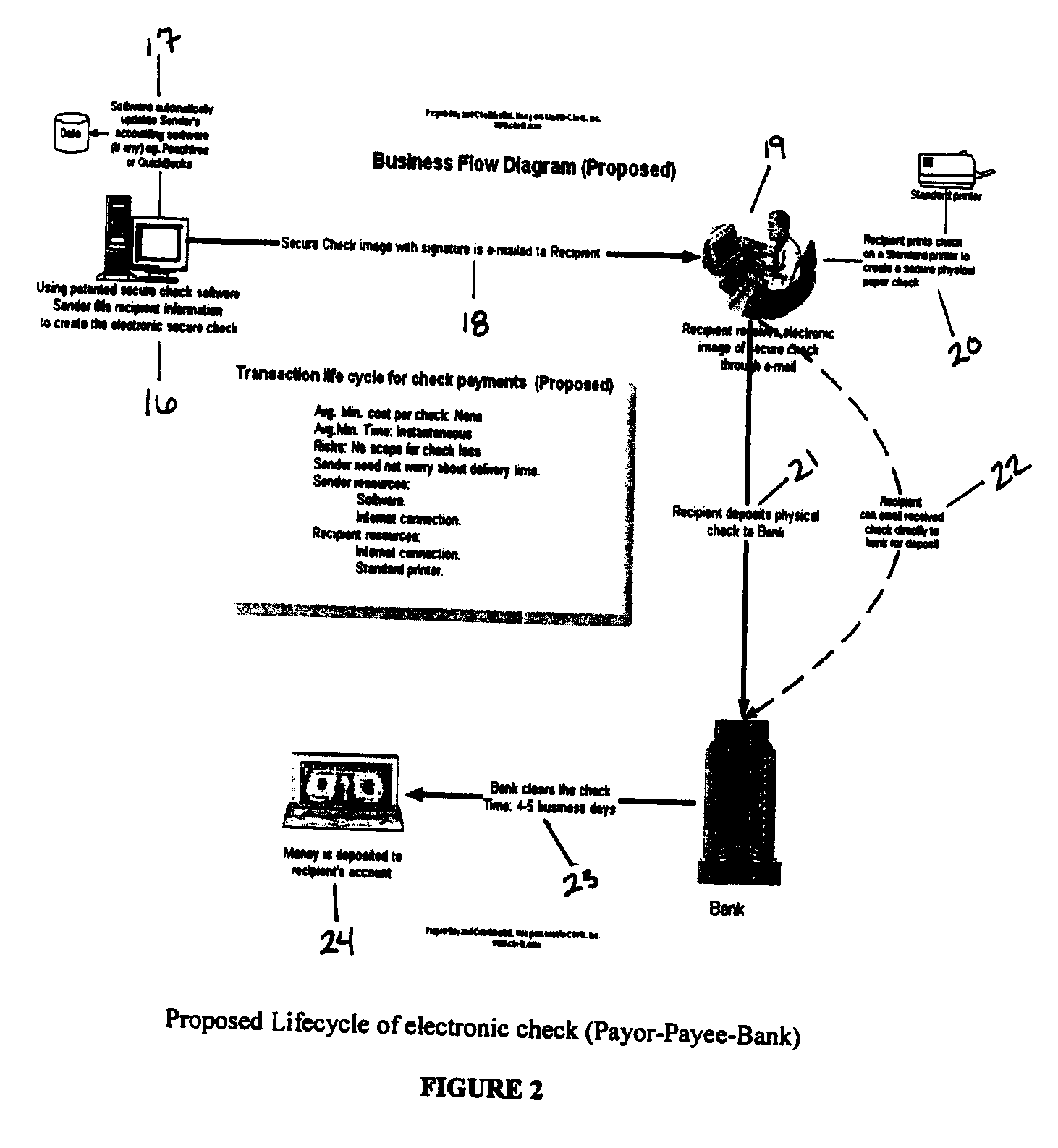

Electronic check

ActiveUS20060161501A1Complete banking machinesFinanceElectronic transmissionComputer graphics (images)

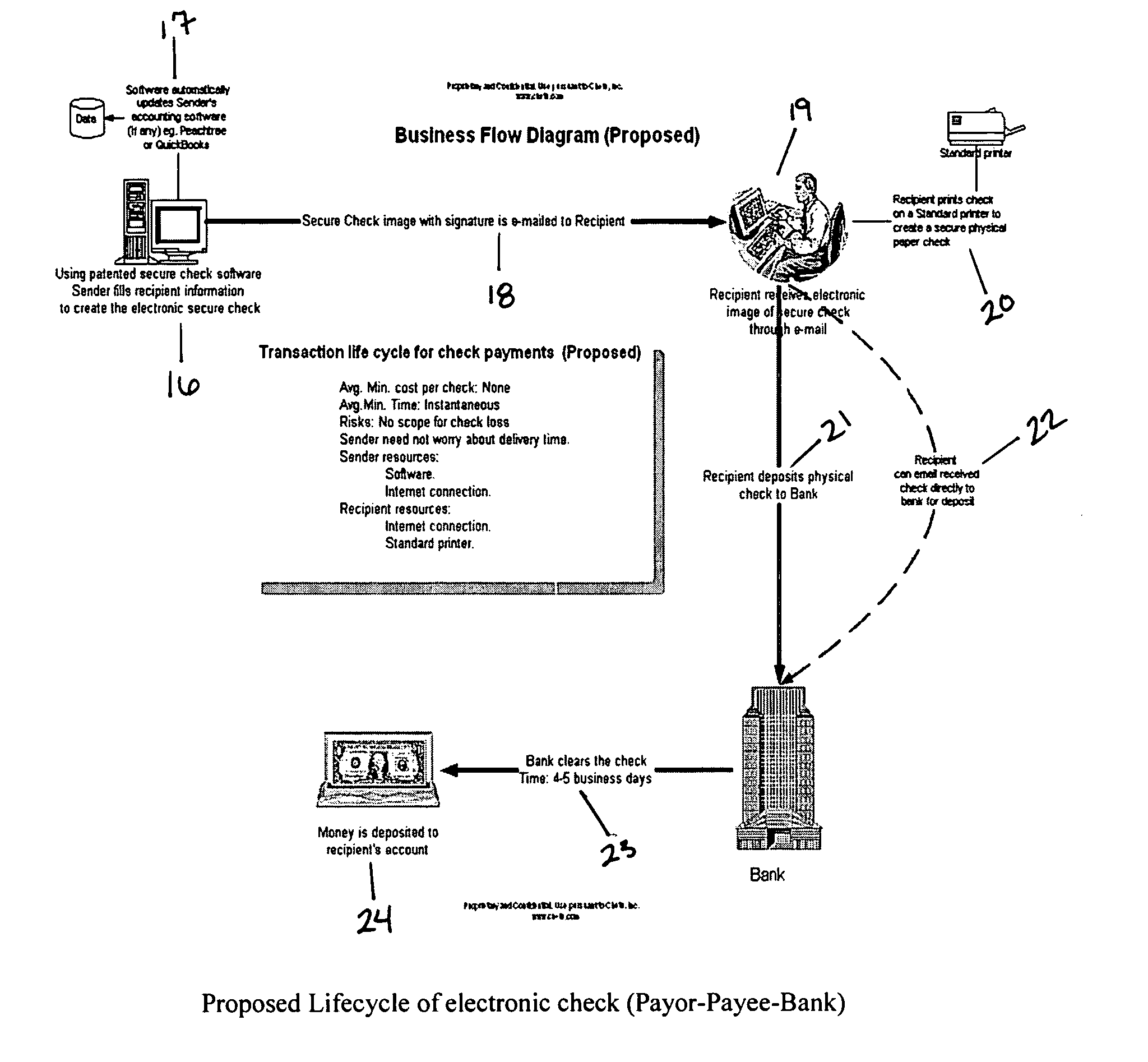

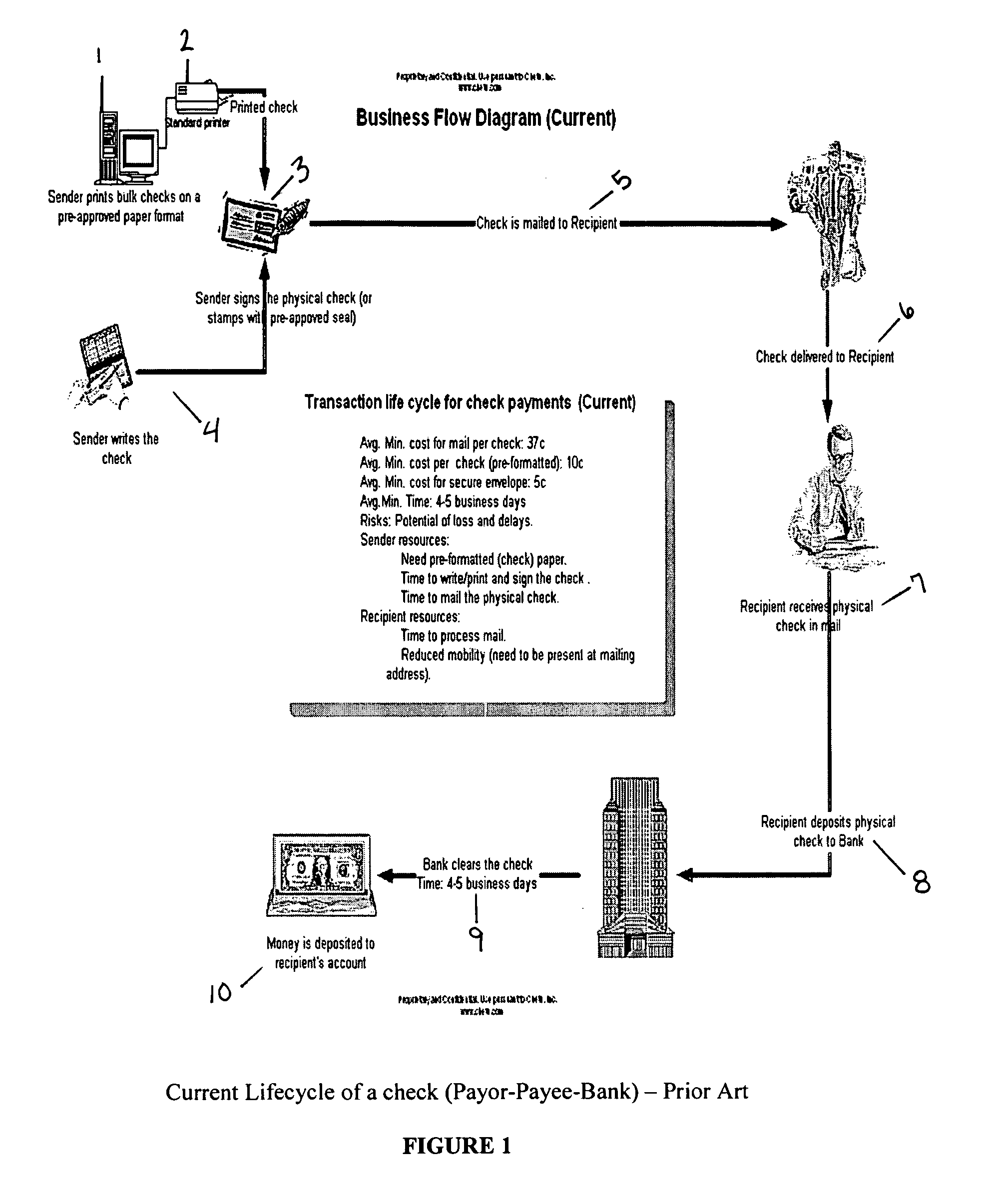

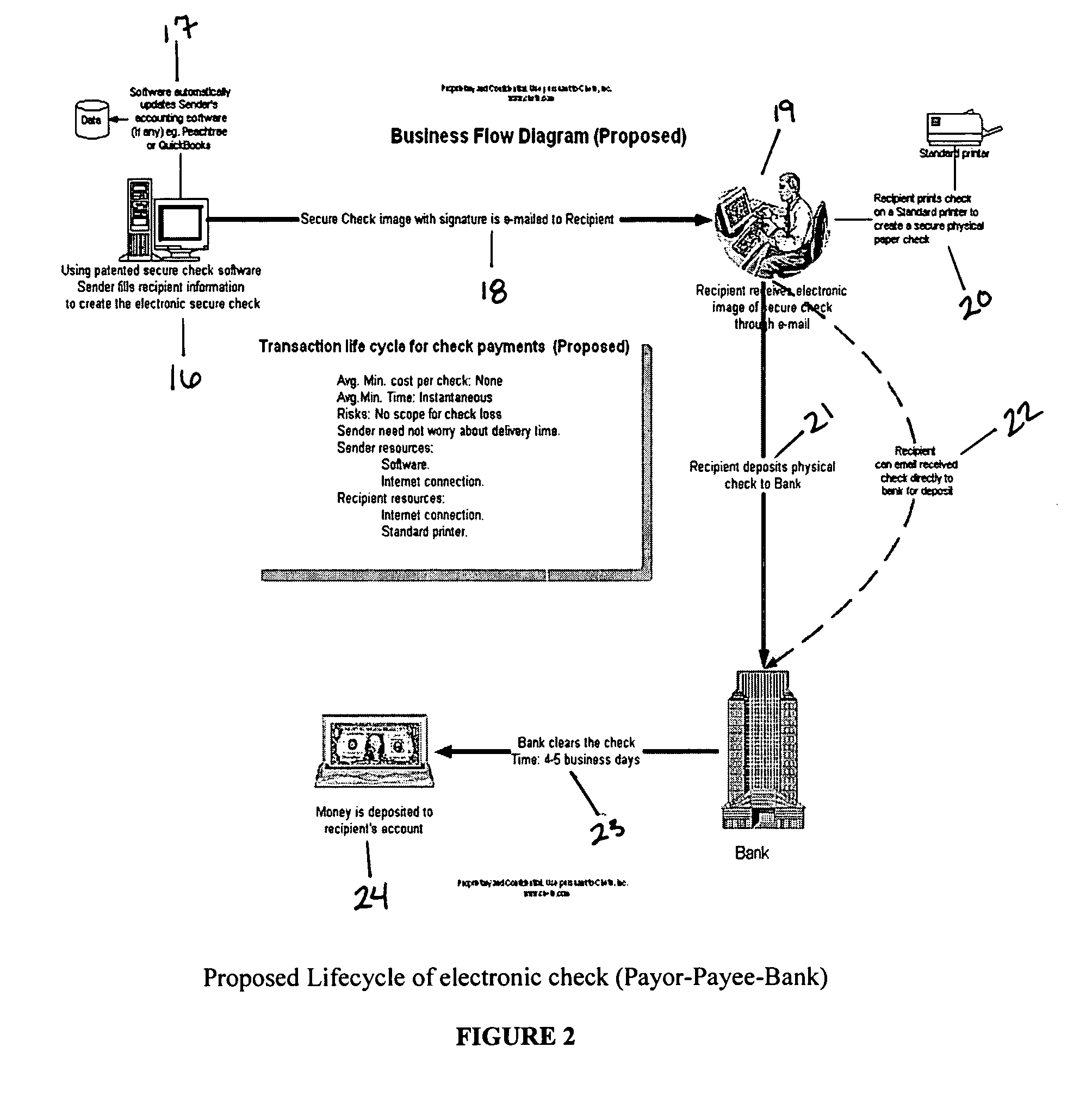

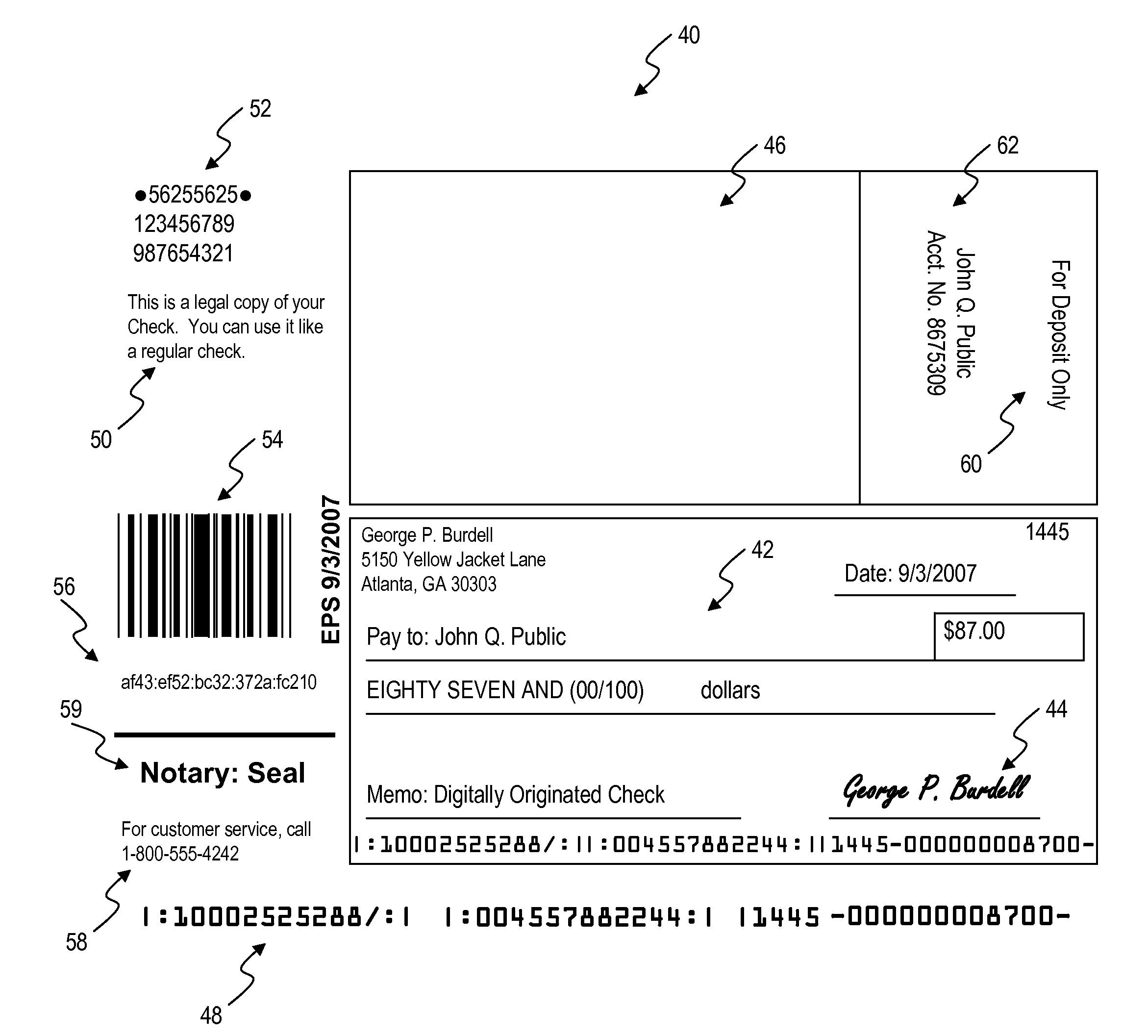

An electronic check that is created by a secure electronic transmission which can be printed as a paper check by the payee. The electronic check is created by a software program that makes a digital image of the check, securely encrypts the digital image and transmits the digital image to the payee. The payee then uses special software to decrypt the transmitted check image, which is then capable of being printed as a paper check by the payee. The payee can deposit the paper check to the bank. Optionally, the payee can electronically transmit the check image to the payee's bank.

Owner:ECHECK21

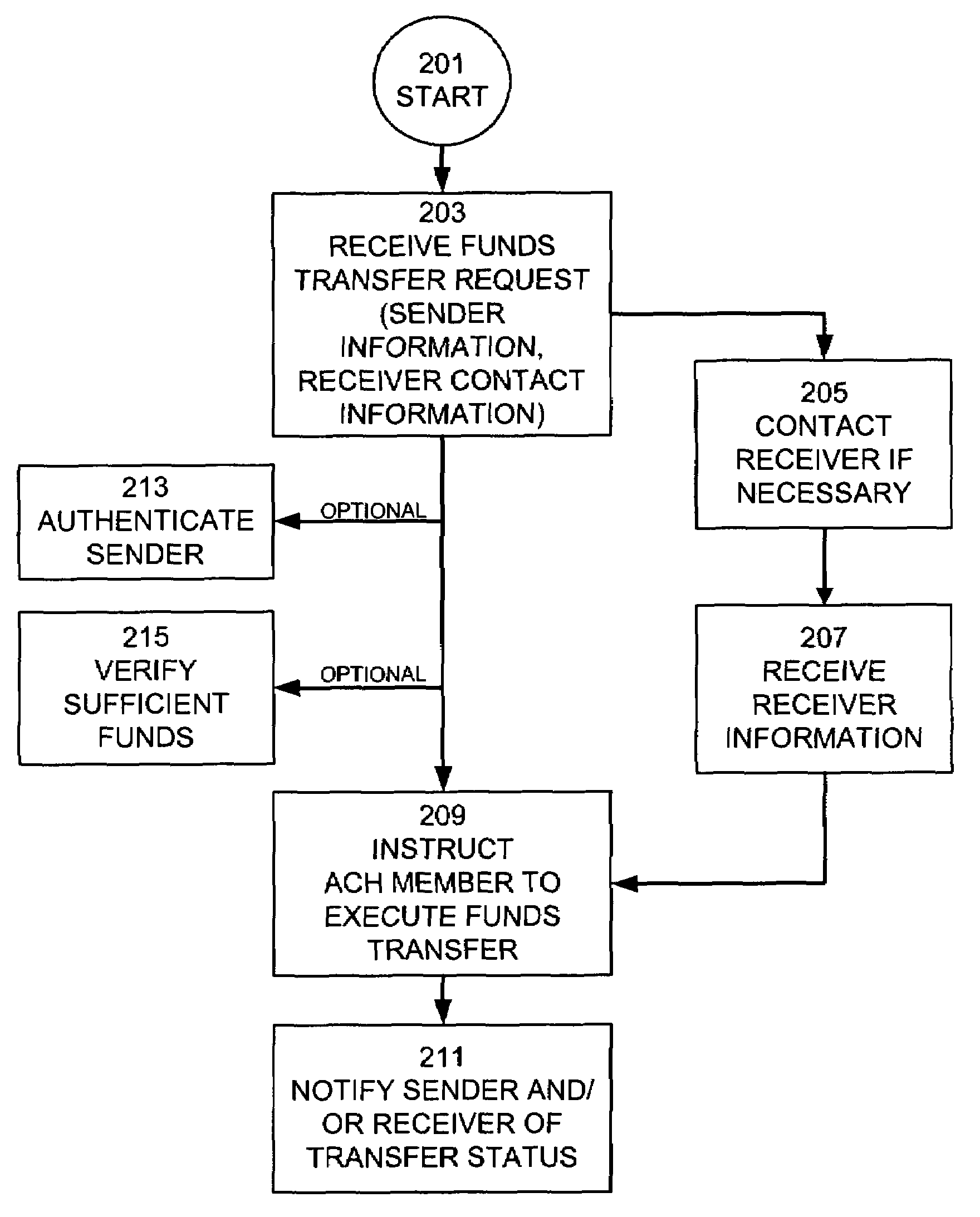

Consumer-directed financial transfers using automated clearinghouse networks

InactiveUS7395241B1Allocation is accurateEliminate contactComplete banking machinesFinanceThe InternetCheque

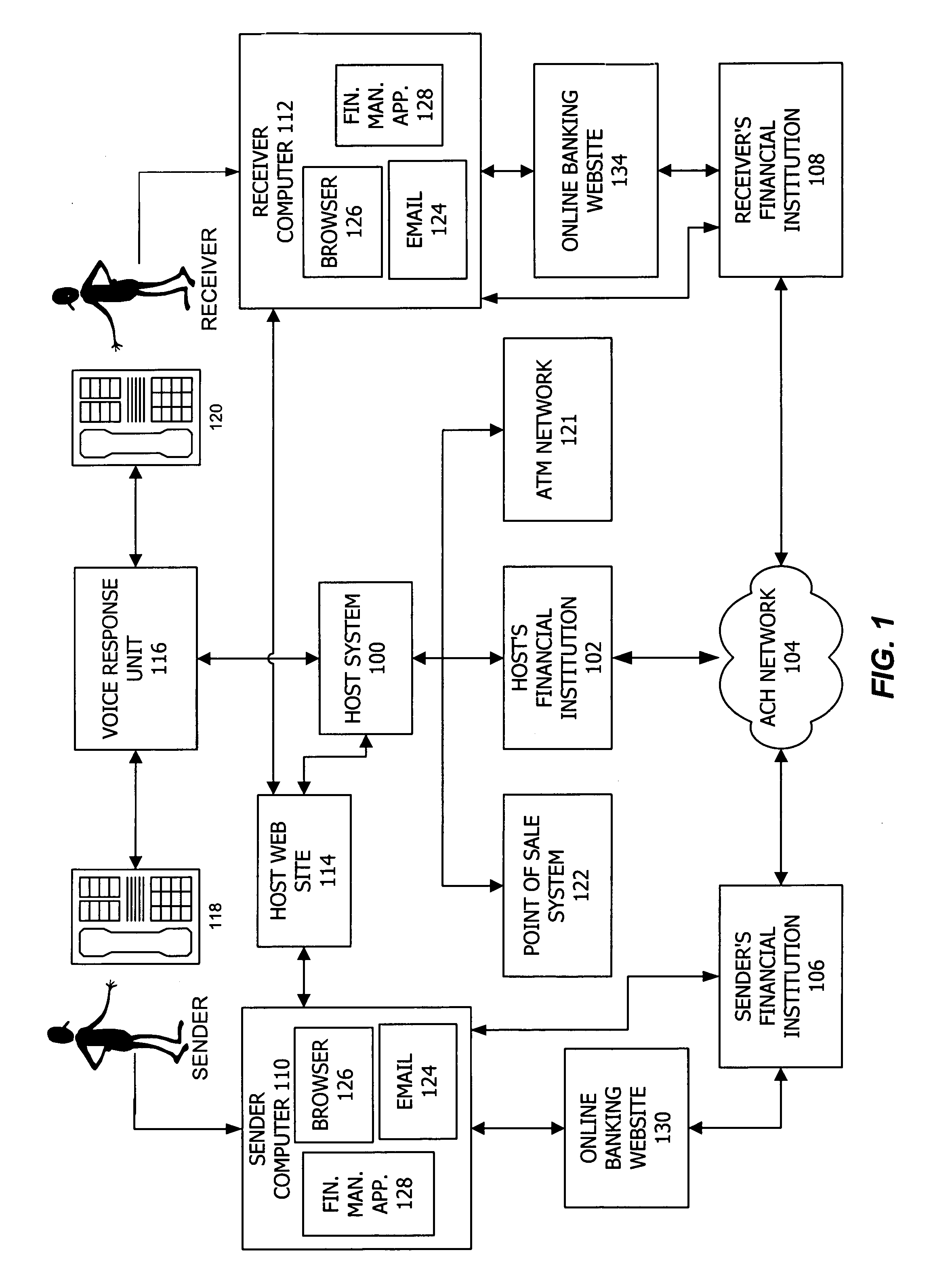

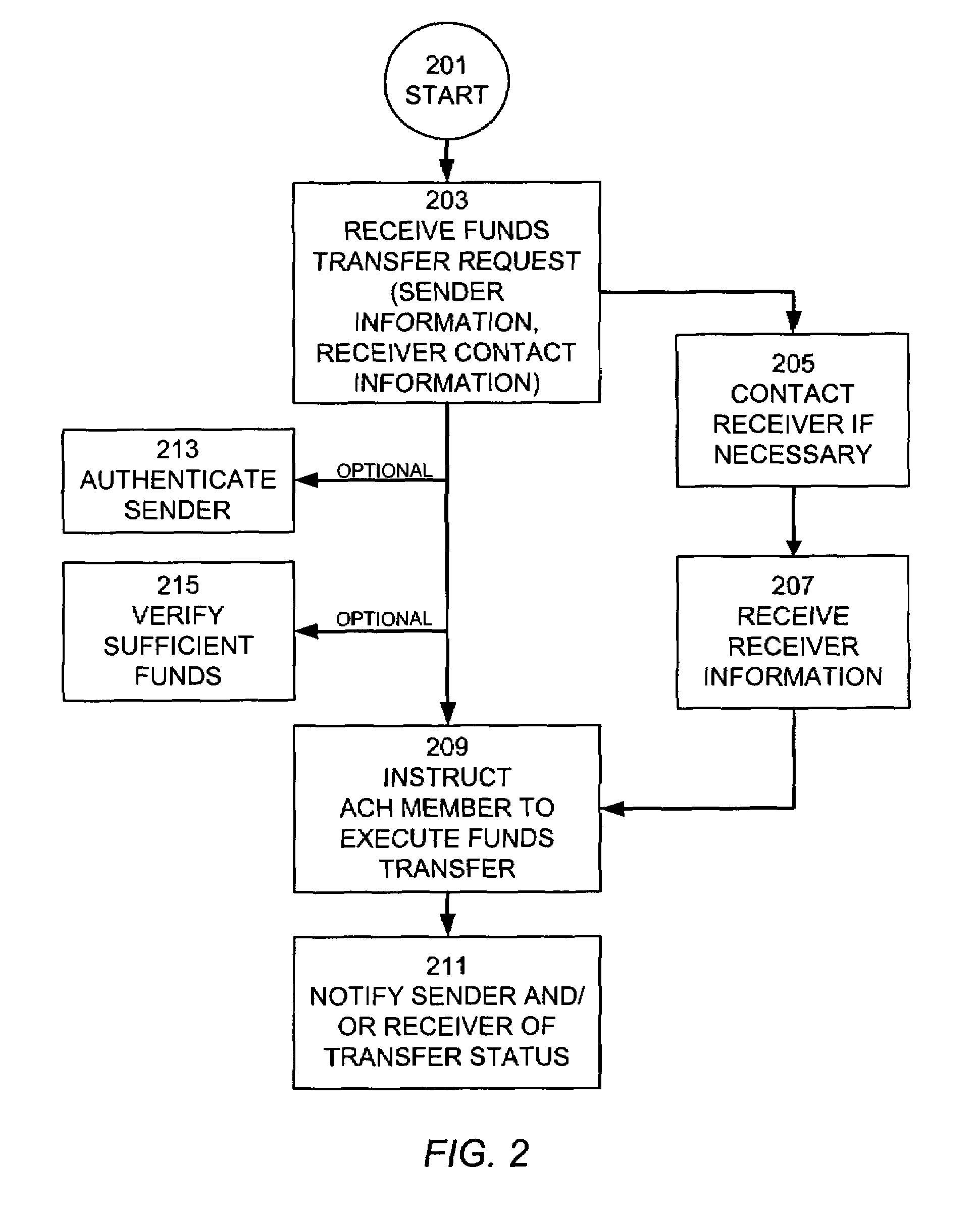

Consumer directed transfers of funds over the Internet are provided by a combination of systems and networks, including the Internet, email, and the Automated Clearinghouse system (ACH). A host system provided by a funds transfer service manages requests of senders to transfer funds and further manages responses of receivers to claim funds. The host system allows the sender to initiate the funds transfer by specifying the amount of the transfer and information for contacting the receiver, without the need to specify the account of the receiver for receiving the funds. Instead, the host system contacts the receiver and informs the receiver of the available funds; the receiver can then provide the necessary target account information for completing the funds transfer. The ACH is used to effect the transfer of funds, with the host system providing instructions for ACH entries to its financial institution using account information separately received from the sender and receiver. The credit risk associated with originating ACH entries is reduced by use of the Point of Sale system to verify sufficient funds in the sender's account by comparing the closing balance of the day the funds transfer is requested with the transfer amount. Sender fraud is reduced by comparing a sender provided balance (or check number / amounts) with an account balance acquired through automated means such as the POS system or ATM network.

Owner:INTUIT INC

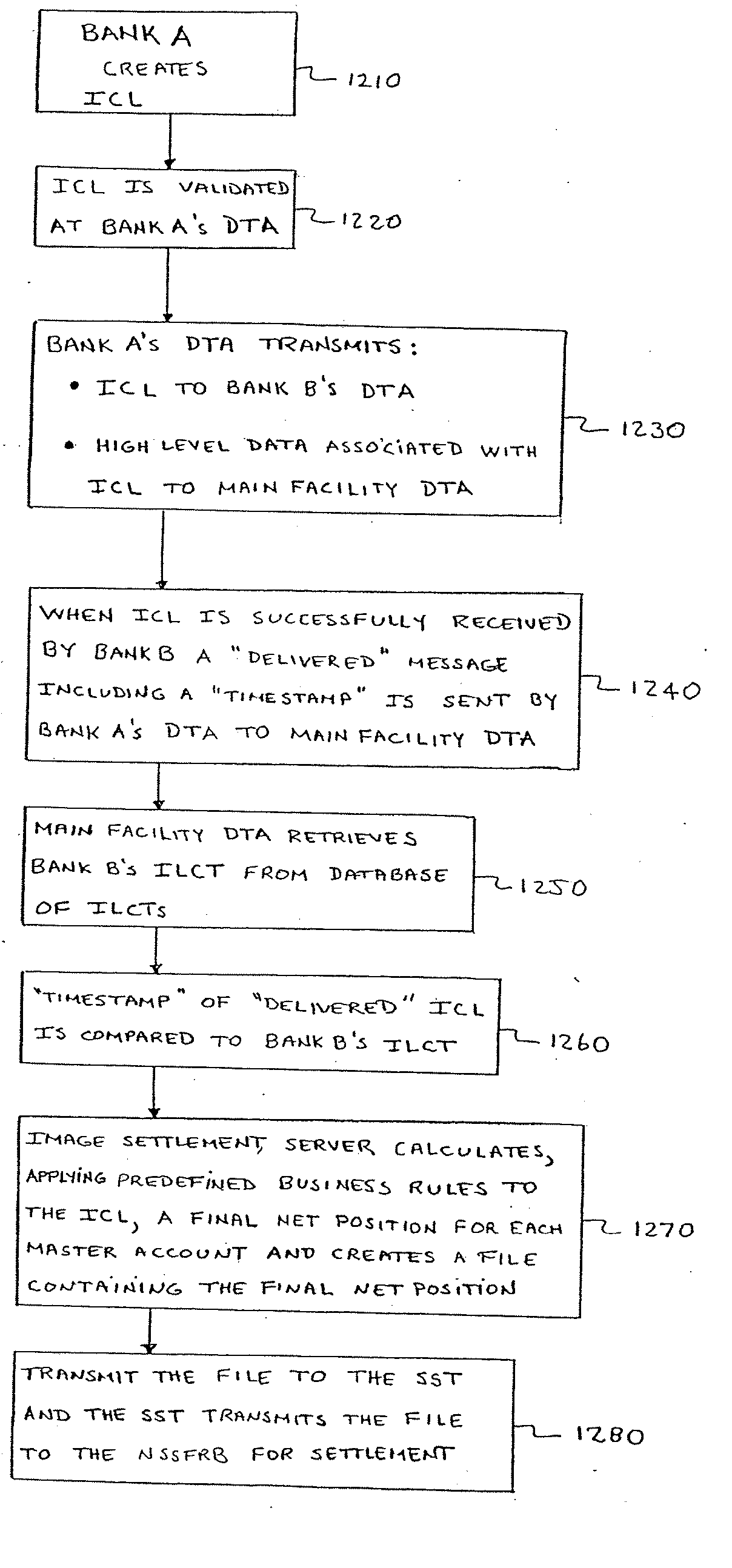

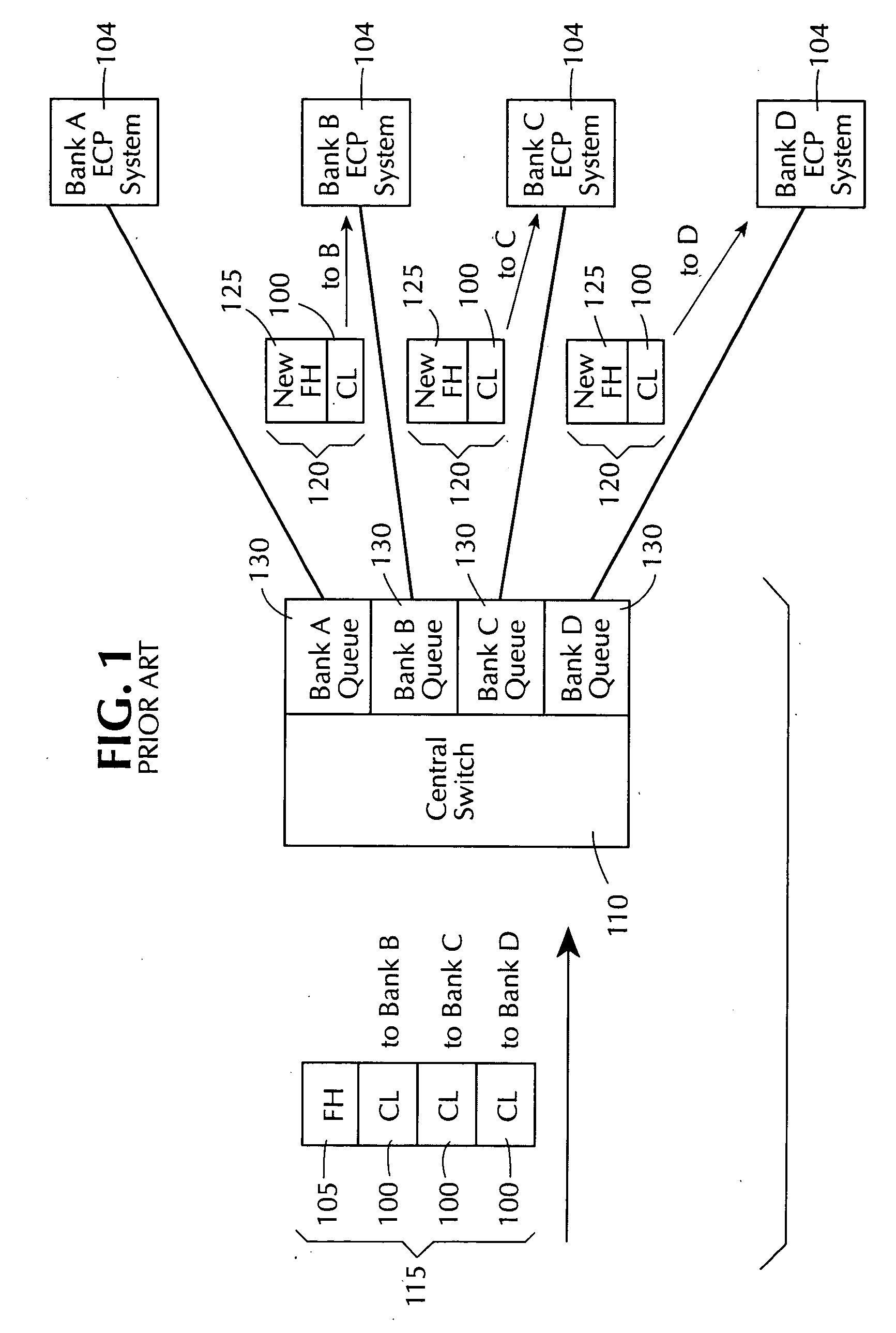

Method and system for electronic settlement of checks

InactiveUS20080097899A1Efficiently clearingEfficiently settlingFinancePayment architectureChequeDatabase

A system is provided for settling cash letters containing check images that are exchanged by banks connected to an image exchange system (IEX). Settlement amounts are computed and sent to the Federal Reserve Banks' National Settlement Service (FRBNSS) for settlement based upon business rules. Further, a method is provided for processing a financial check transaction between a plurality of financial institutions, including at least first and second institutions, the method including providing electronic check data, relating to at least one check to be paid by the second institution, from the first institution to the second institution to effect an automatic check presentment; and automatically performing an electronic settlement determination for the at least one check, based on the electronic check data and predetermined business rules.

Owner:THE CLEARING HOUSE PAYMENTS

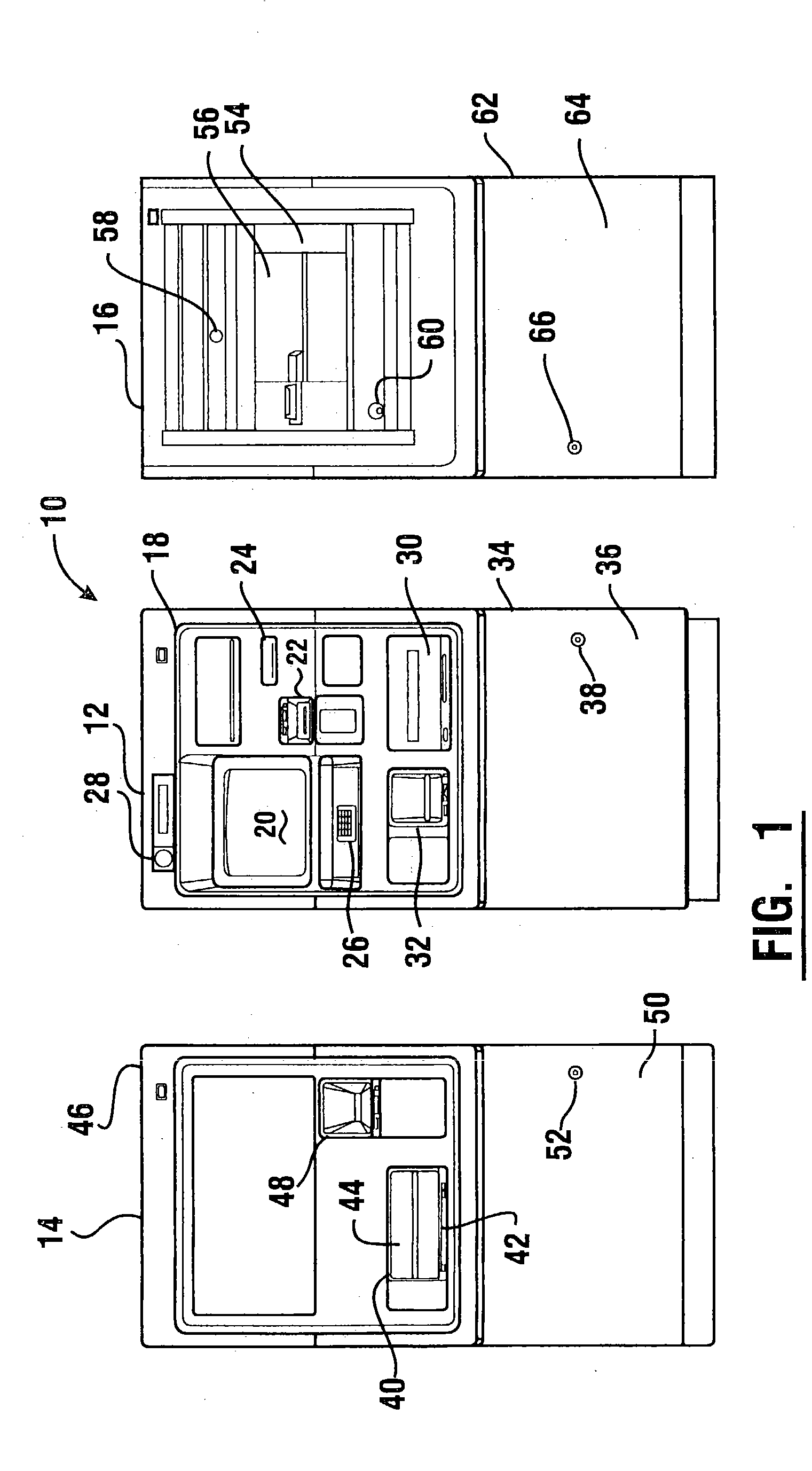

Automated banking apparatus and method

InactiveUS20040016796A1Accurate specificationsGood user interfaceComplete banking machinesCoin/currency accepting devicesFinancial transactionCheque

An automated banking apparatus is operative to carry out banking transactions commonly required by merchants. The apparatus includes an item accepting depository for accepting deposit items, such as deposit bags, currency, and checks. The apparatus further includes an input device that is operative to interrogate an RFID tag to obtain merchant deposit information therefrom. The information can include data representative of the deposit, such as an account number and the deposit amount. The RFID tag may be located on an item being deposited.

Owner:DIEBOLD NIXDORF

Electronic check

An electronic check that is created by a secure electronic transmission which can be printed as a paper check by the payee. The electronic check is created by a software program that makes a digital image of the check, securely encrypts the digital image and transmits the digital image to the payee. The payee then uses special software to decrypt the transmitted check image, which is then capable of being printed as a paper check by the payee. The payee can deposit the paper check to the bank. Optionally, the payee can electronically transmit the check image to the payee's bank.

Owner:ECHECK21

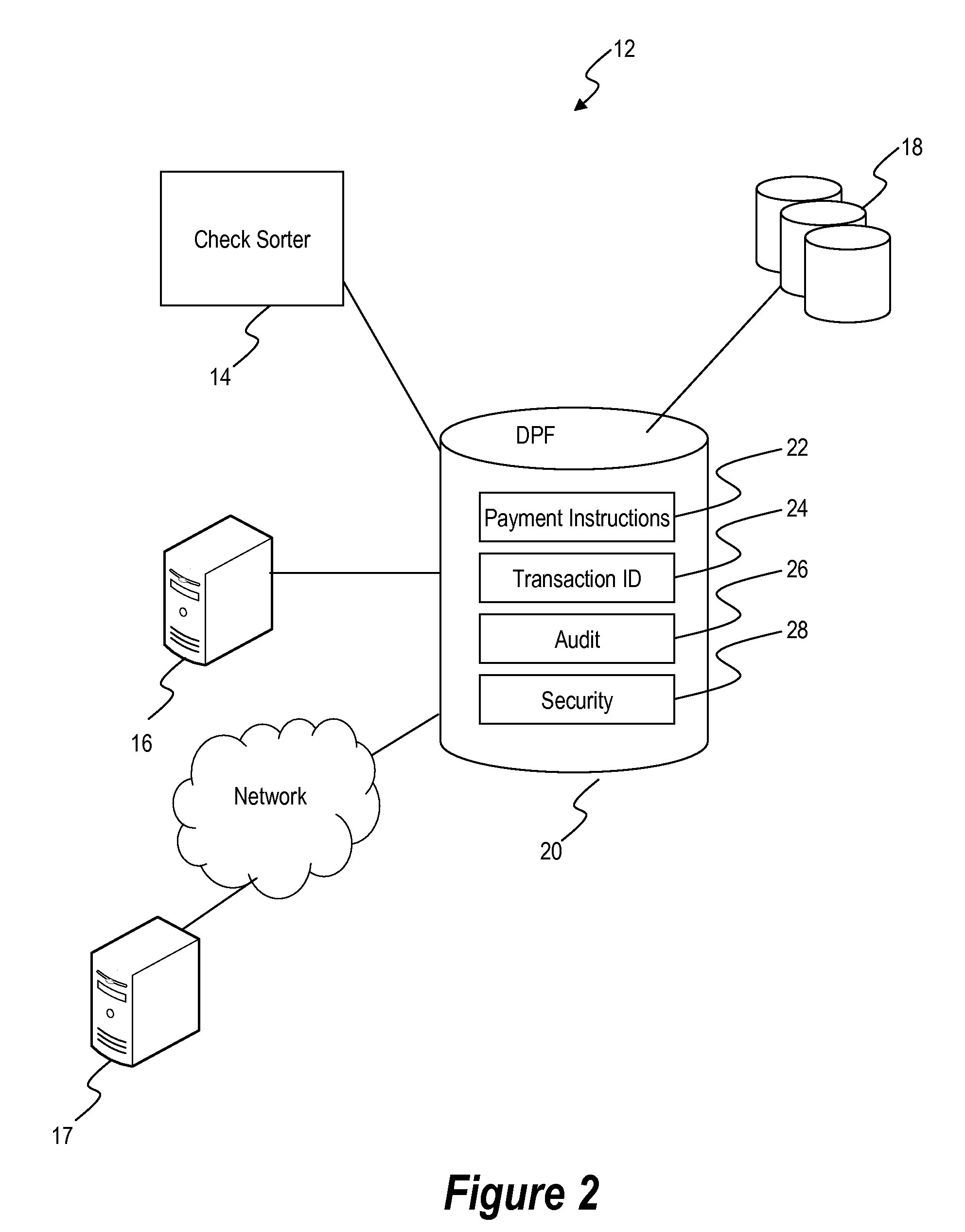

Systems and methods for check 21 image replacement document enhancements

InactiveUS20080247629A1Simple processAdd featureFinanceCharacter and pattern recognitionDocumentation procedureCheque

The present invention provides enhanced processing of Check 21 items using an electronic payment system (EPS) to capture metadata instructions. The metadata includes instructions regarding an intended payment to a payee, and can be generated through a truncation process and optical character recognition, directly from a digitally originated check, and the like. The metadata is stored in a database or the like for further processing instead of printing a paper check. In various exemplary embodiments, the present invention provides a capability to print Image Replacement Documents (IRDs) compliant to Check 21 regulations from the metadata. Further, these IRDs can include enhanced features as described herein.

Owner:GLOBAL STANDARD FINANCIAL

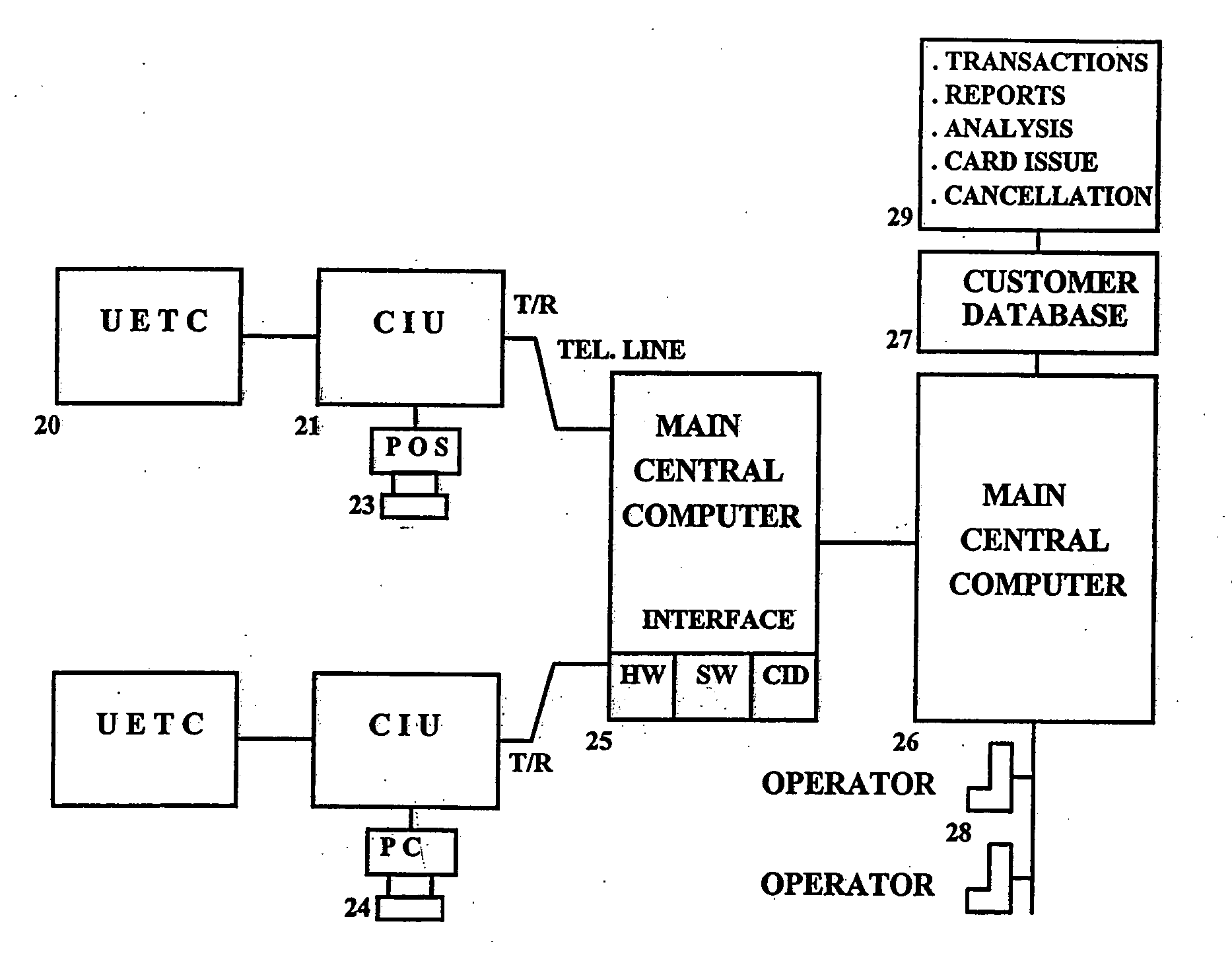

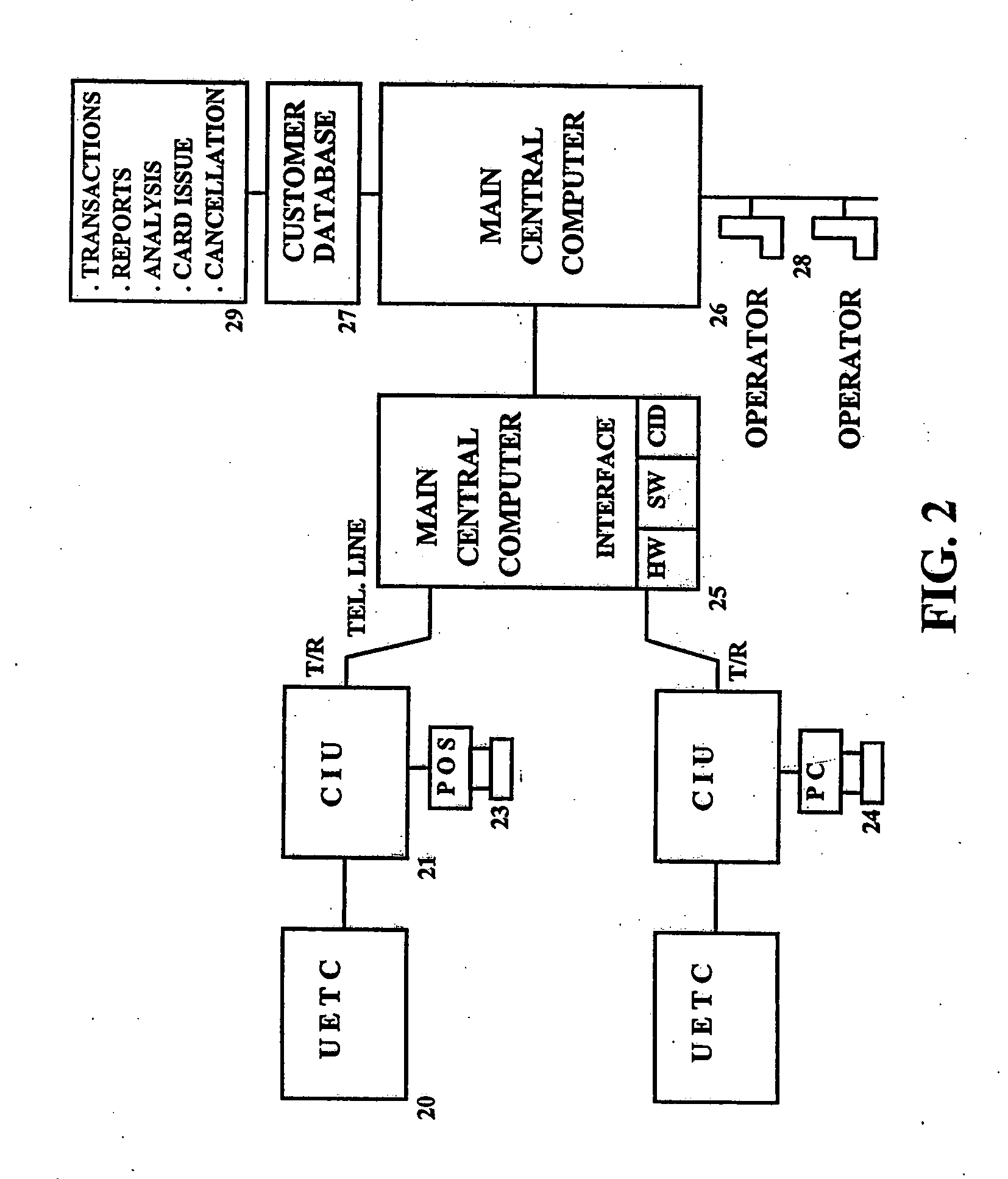

Device, system and methods of conducting paperless transactions

InactiveUS20050247777A1Eliminate pointEliminate all paper transactions and billsCash registersPatient personal data managementCredit cardDisplay device

A universal electronic transaction card (“UET card”) is capable of serving as a number of different credit cards, bank cards, identification cards, employee cards, medical cards and the like. The UET card includes storage elements, an input interface, a processor, a display, and a communications interface. In a preferred embodiment, the UET card stores transactional information to eliminate paper receipts and includes security features to prevent unauthorized use. The UET card may also be used to replace conventional currency and traveler's checks, and may be configured to store and display promotional information, such as advertising and incentives. A communications interface unit (“CIU”) may be provided to interface between the UET card and a personal computer, automatic banking terminal (commonly referred to as ATM machines) and / or an institutional mainframe computer. CIU devices may include electrical contact for recharging a UET card. A system of utilizing the UET card is also provided which includes UET cards and CIU devices which enable the transmission of information between point of sales (or point of transactions) computers and the UET cards. The system further includes point of sales computers configured to communicate with the UET card and with service institution computers. The invention also includes a health care management system utilizing UET cards. In the health care management system, all medical information for a patient may be stored in the UET card so that when a patient receives services from a health care provider, that health care provider connects the patient's UET card to the health care provider's computer system and can then obtain all pertinent medical information concerning the patient, including the patient's medical history, insurance information and the like. In addition, the treatment or services provided by the health care provider are stored in the patient's UET card. The invention also includes methods of issuing an account authorization to a UET card, a method of transferring transactional and account information between a UET card and a personal computer or a mainframe computer, a method of using the UET card as a remote terminal for a mainframe computer, and a method of conducting an electronic transaction.

Owner:C SAM INC

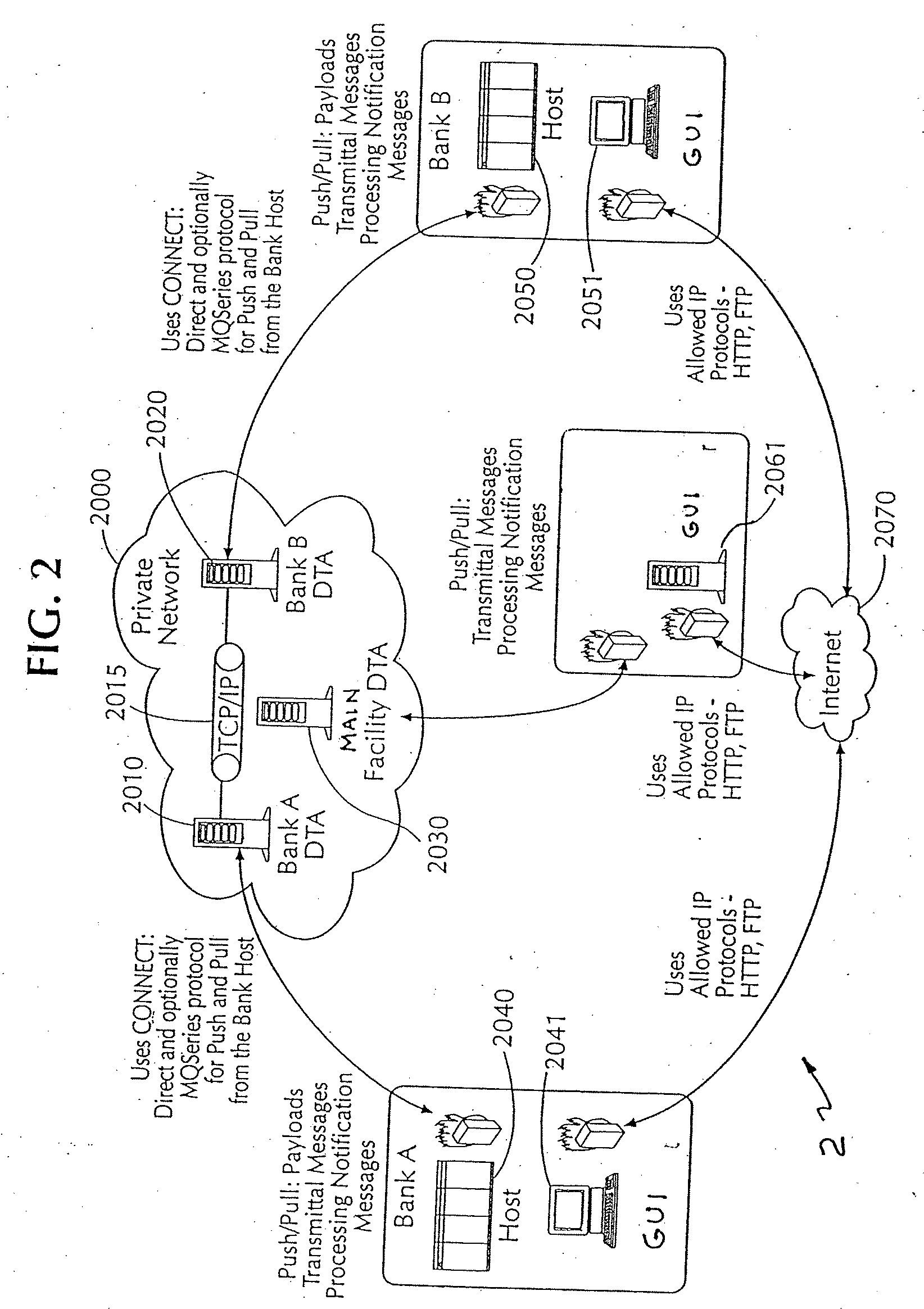

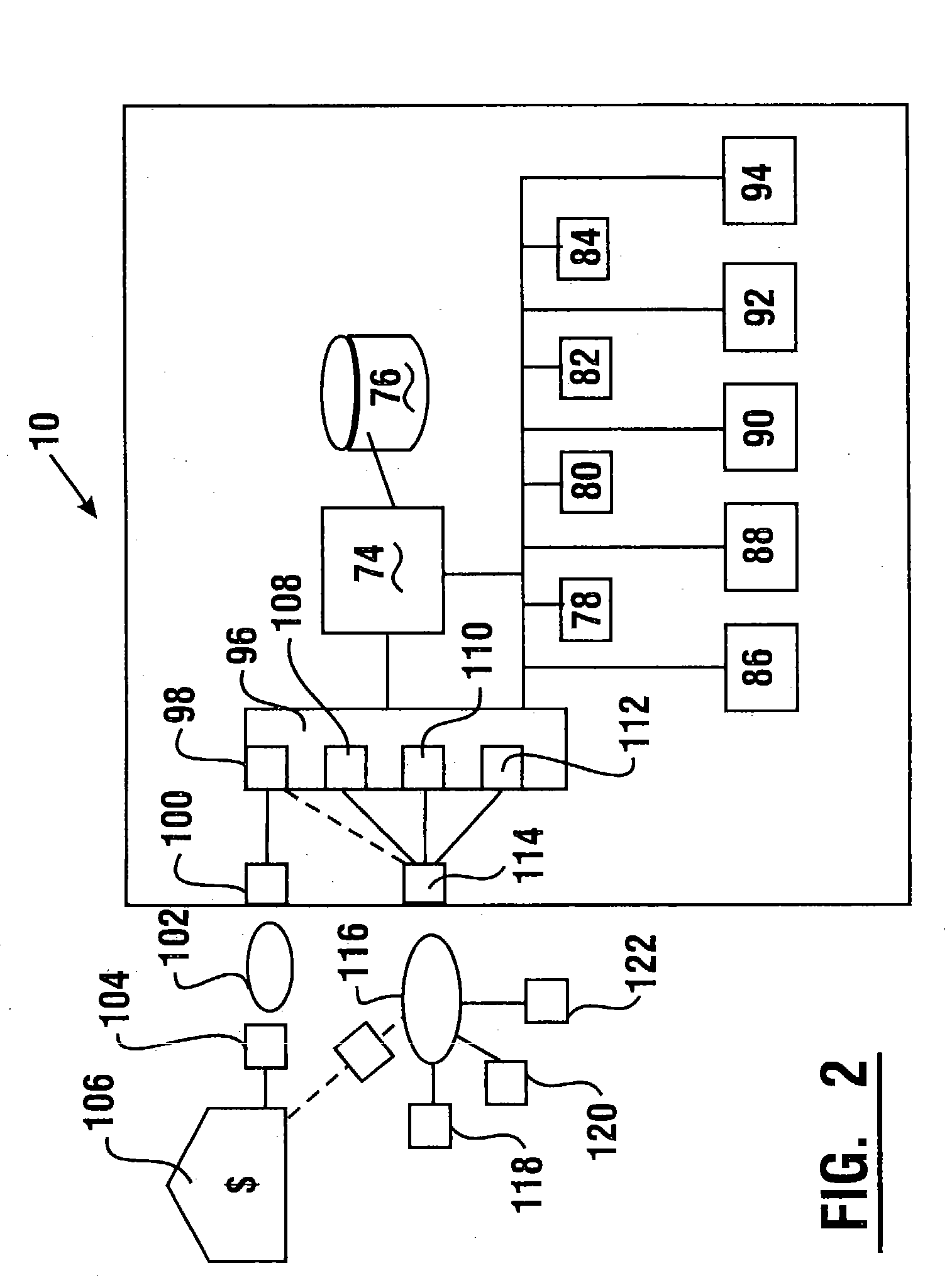

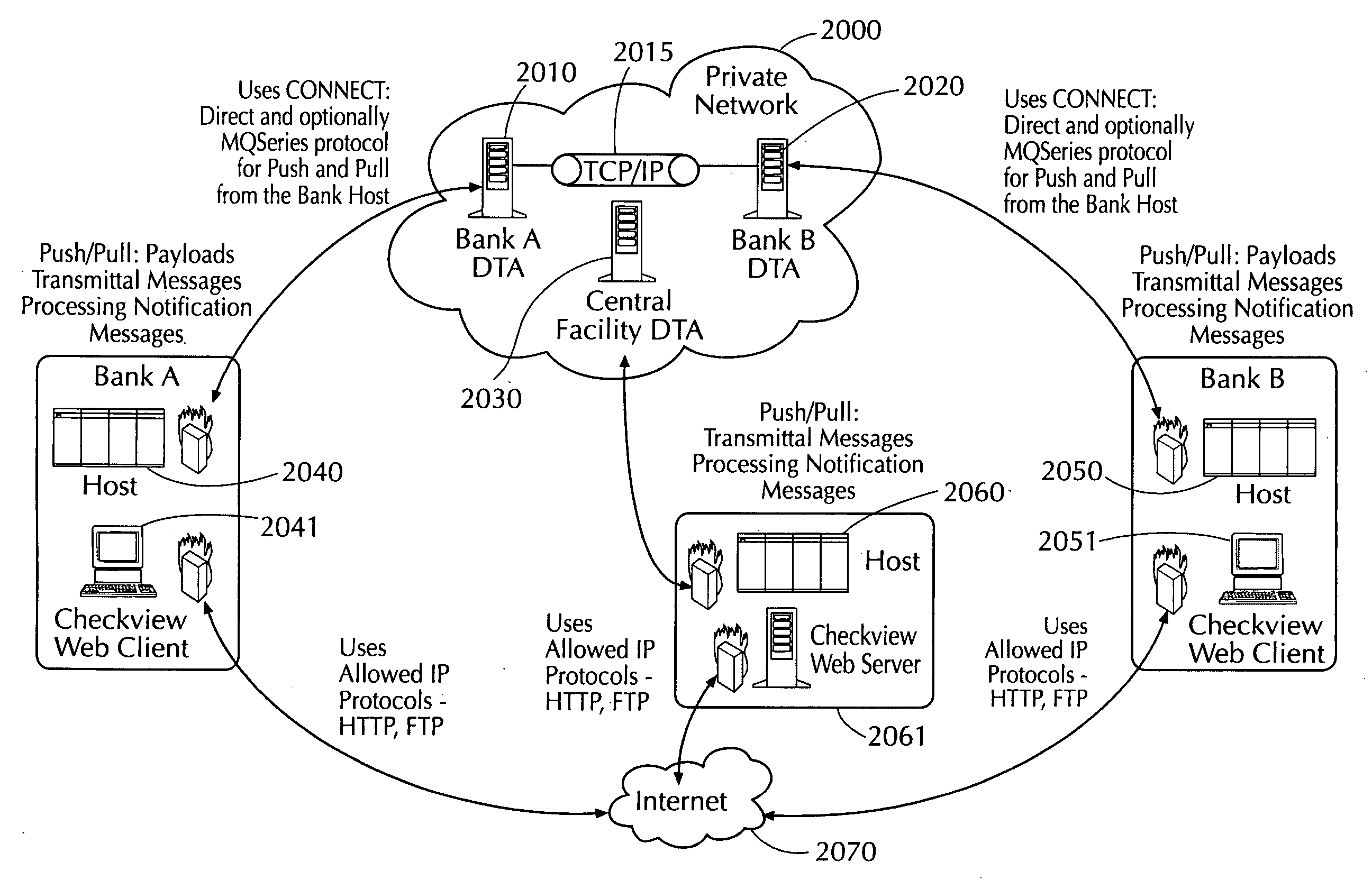

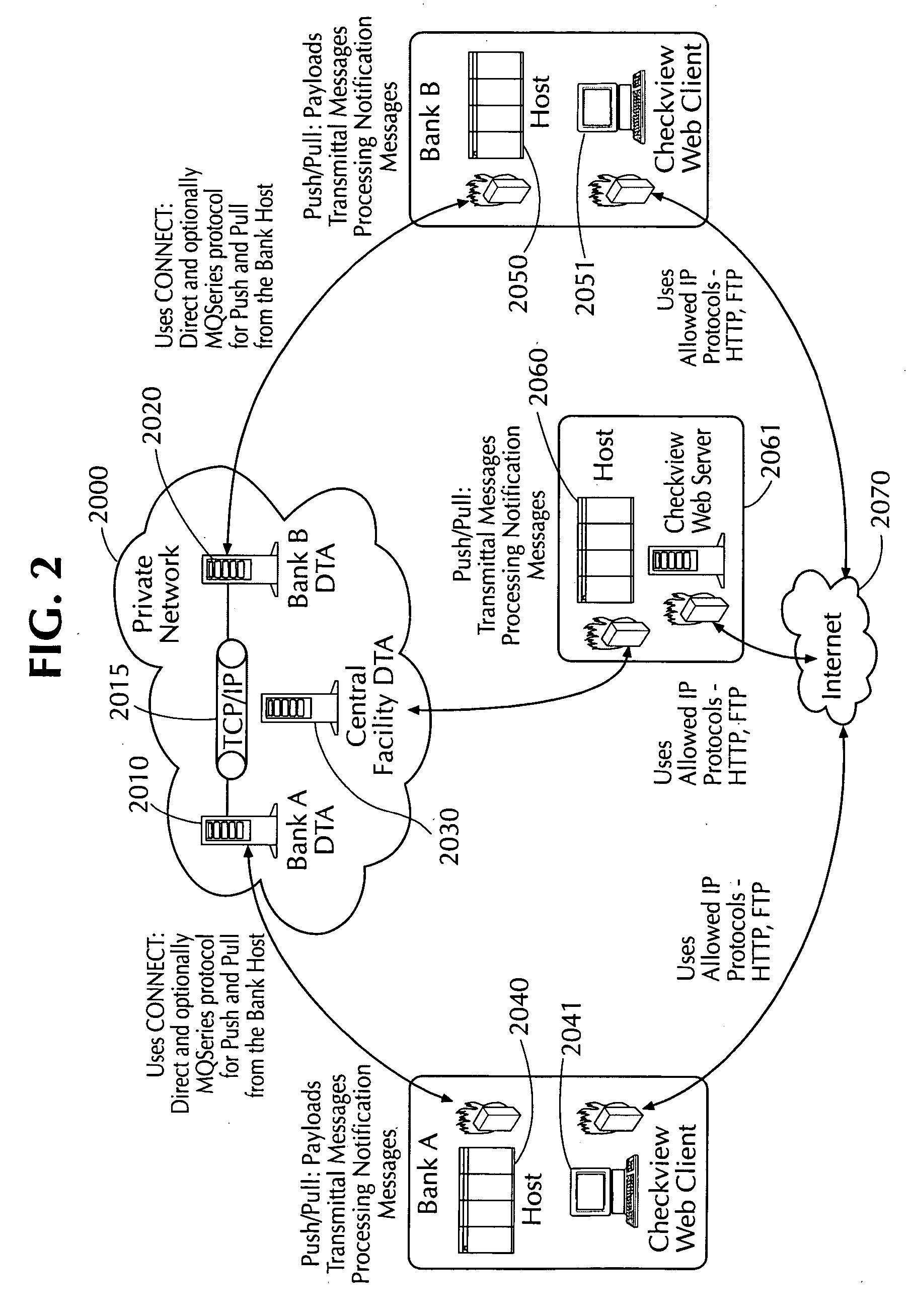

Electronic payment clearing and check image exchange systems and methods

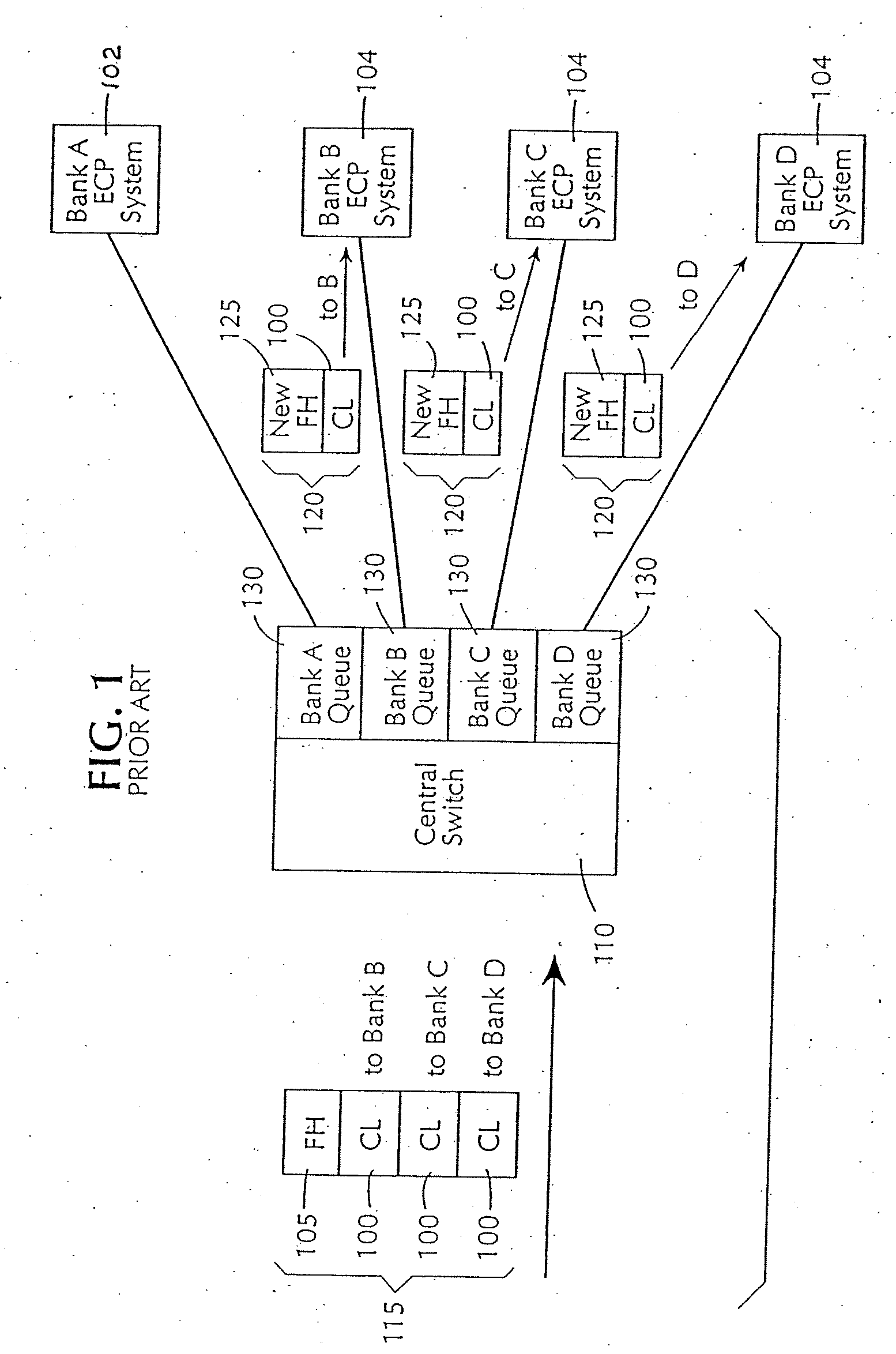

A system and corresponding method are provided. The system includes a plurality of first entities (such as banks), each first entity communicatively connected to at least one distributed traffic agent (DTA), a second entity (such as a central facility) communicatively connected to a DTA, and a communication network communicatively connecting the DTAs. A payload containing a data file (such as electronic check presentment data, electronic payment data, or any other data type) is communicated from one first entity to another through their respective DTAs via the communication network. In addition, a transmittal containing control information corresponding to the payload is communicated from the one first entity to the second entity through their respective DTAs via the communication network.

Owner:THE CLEARING HOUSE PAYMENTS

Method and system of evaluating checks deposited into a cash dispensing automated banking machine

InactiveUS7377425B1Improve reliabilityReduce riskComplete banking machinesFinanceTransaction dataCheque

An automated banking machine system and method includes ATMs which accept checks and dispense cash to users. The ATMs are operated to acquire image and magnetic data from deposited checks to determine the genuineness of checks and the authority of a user to receive cash for such checks. Cash may be dispensed to the user from the ATM in exchange for the deposited check. The ATMs dispense cash responsive to communications with a transaction host. The transaction host provides transaction identifying data to the ATM. The ATM sends the transaction identifying data and check images to an image and transaction data server for processing.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

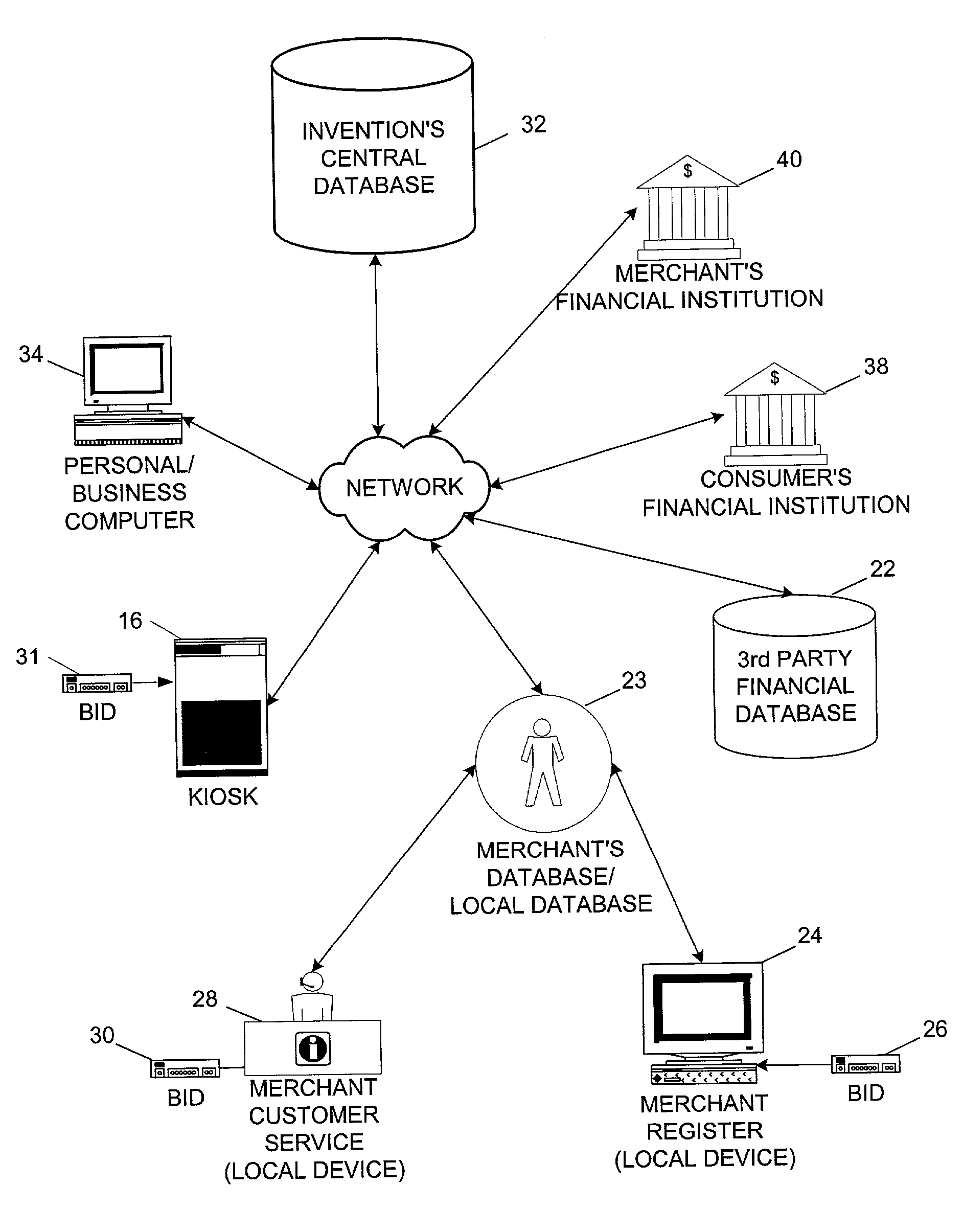

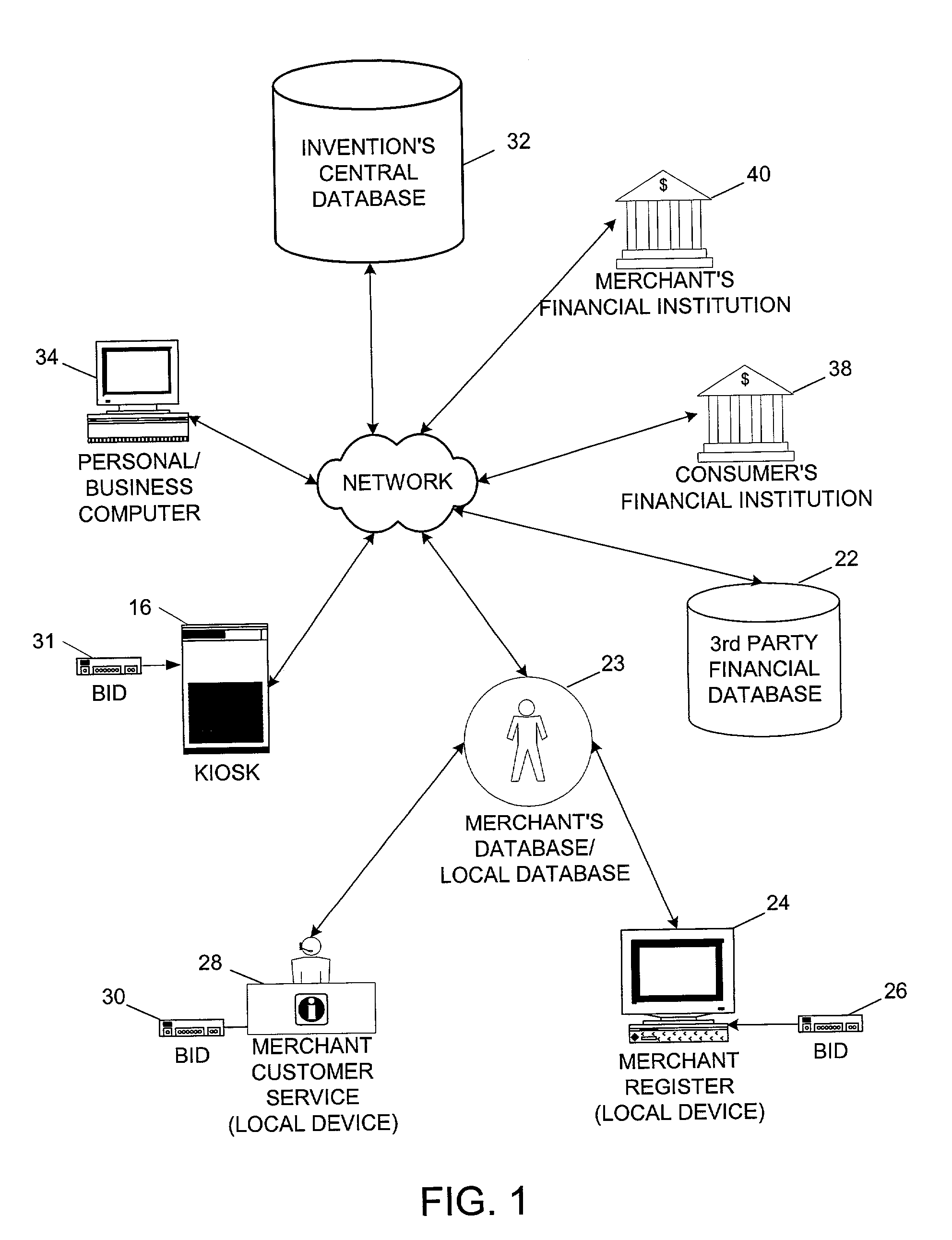

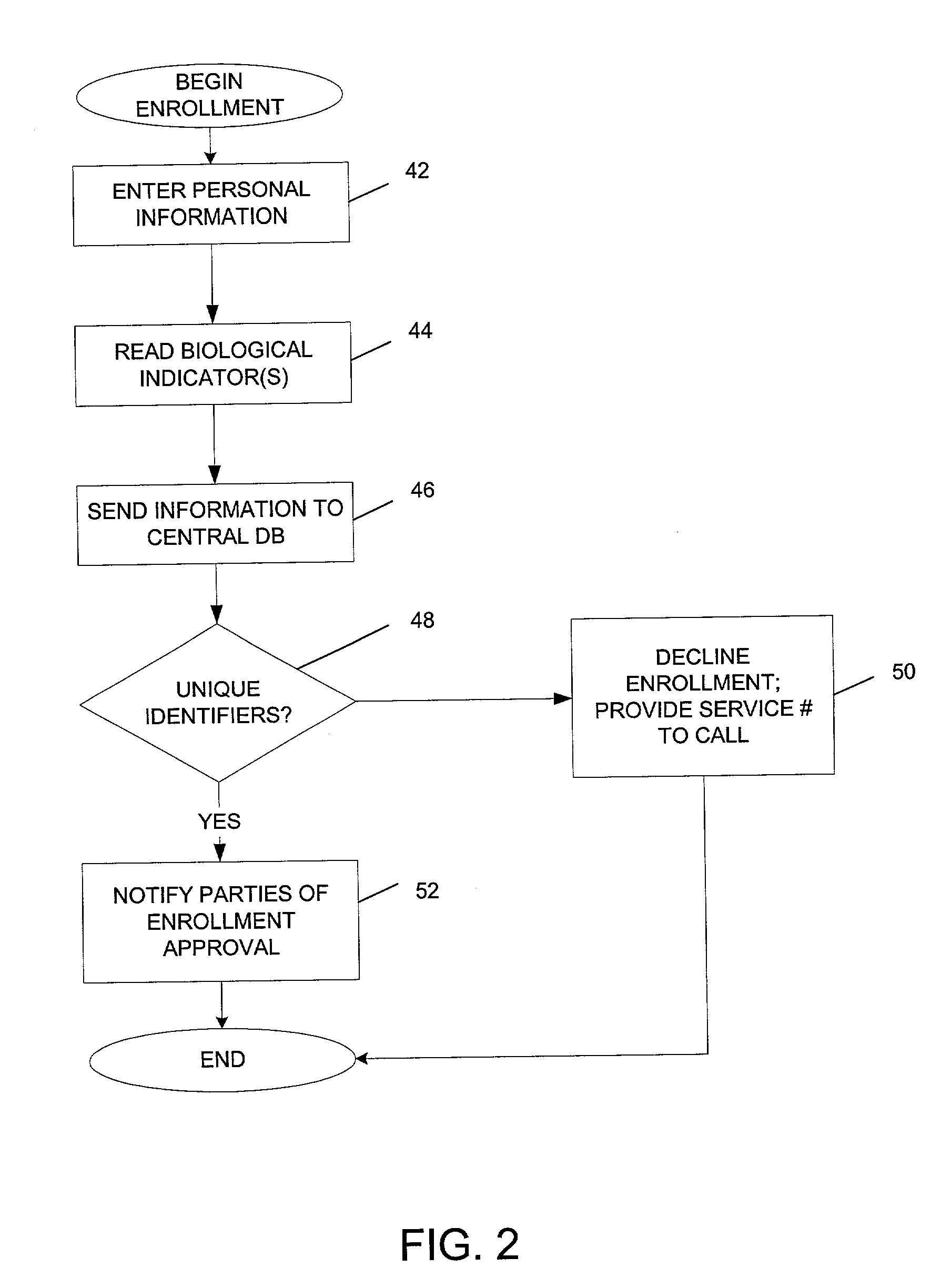

System and method for biometric authorization for check cashing

A system for authorizing a check cashing transaction between a consumer and a merchant using identity verification based on biometric information. A system comprises a central biometric information database containing biometric and personal identity-verifying data registered therein by a consumer and containing merchant identity-verifying data registered therein by a merchant. The system further comprises a merchant local device having a biometric reader and linked via a network to the central biometric information database. Using the biometric reader, a consumer desiring to cash a check presents biometric data to the central biometric information database via the biometric reader. The central biometric information database provides an electronic comparison of the present biometric data with the biometric data registered by the consumer. If the presented data and the registered data match, an approval signal is transmitted to the merchant local device.

Owner:VALSOFT CORP INC

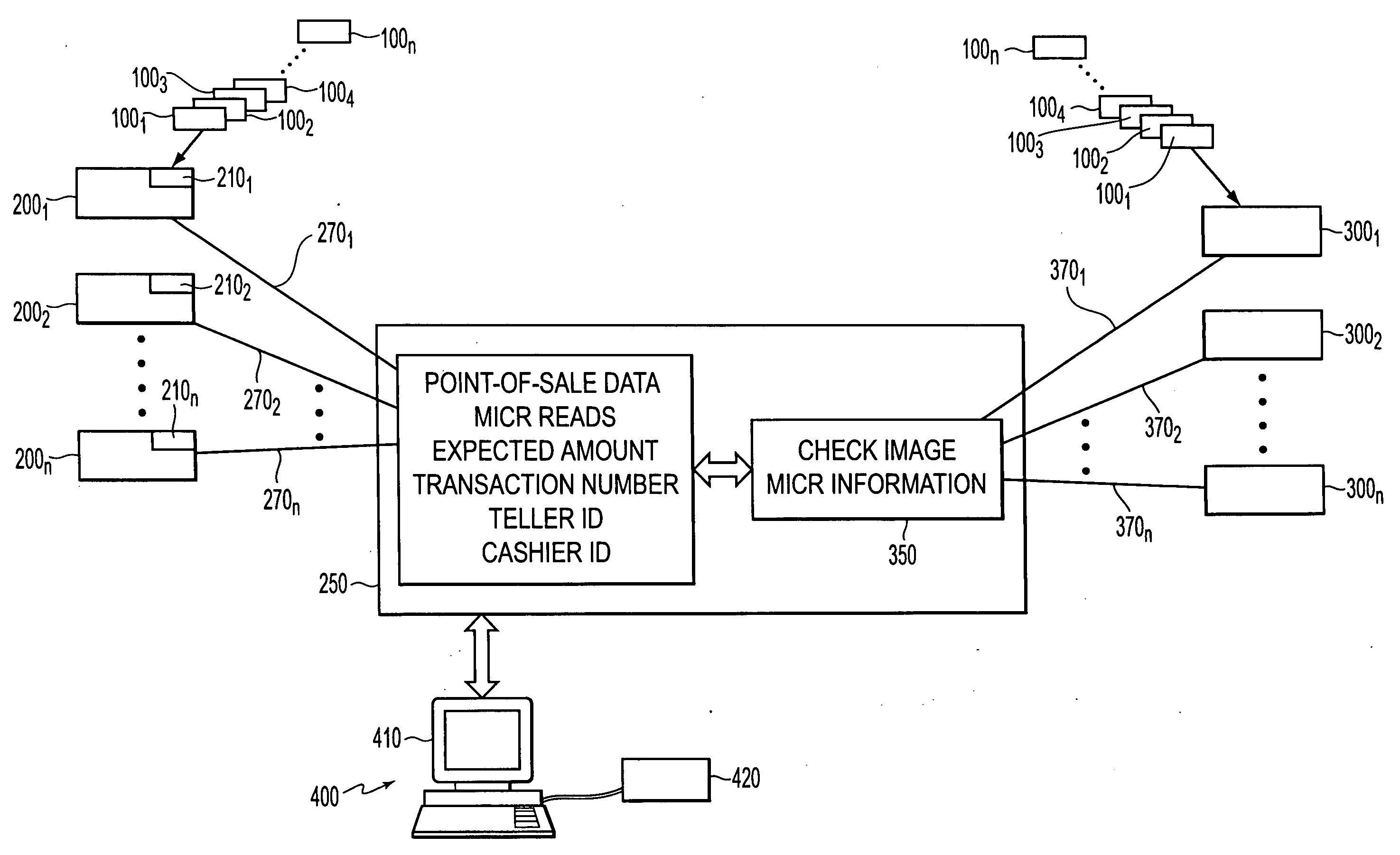

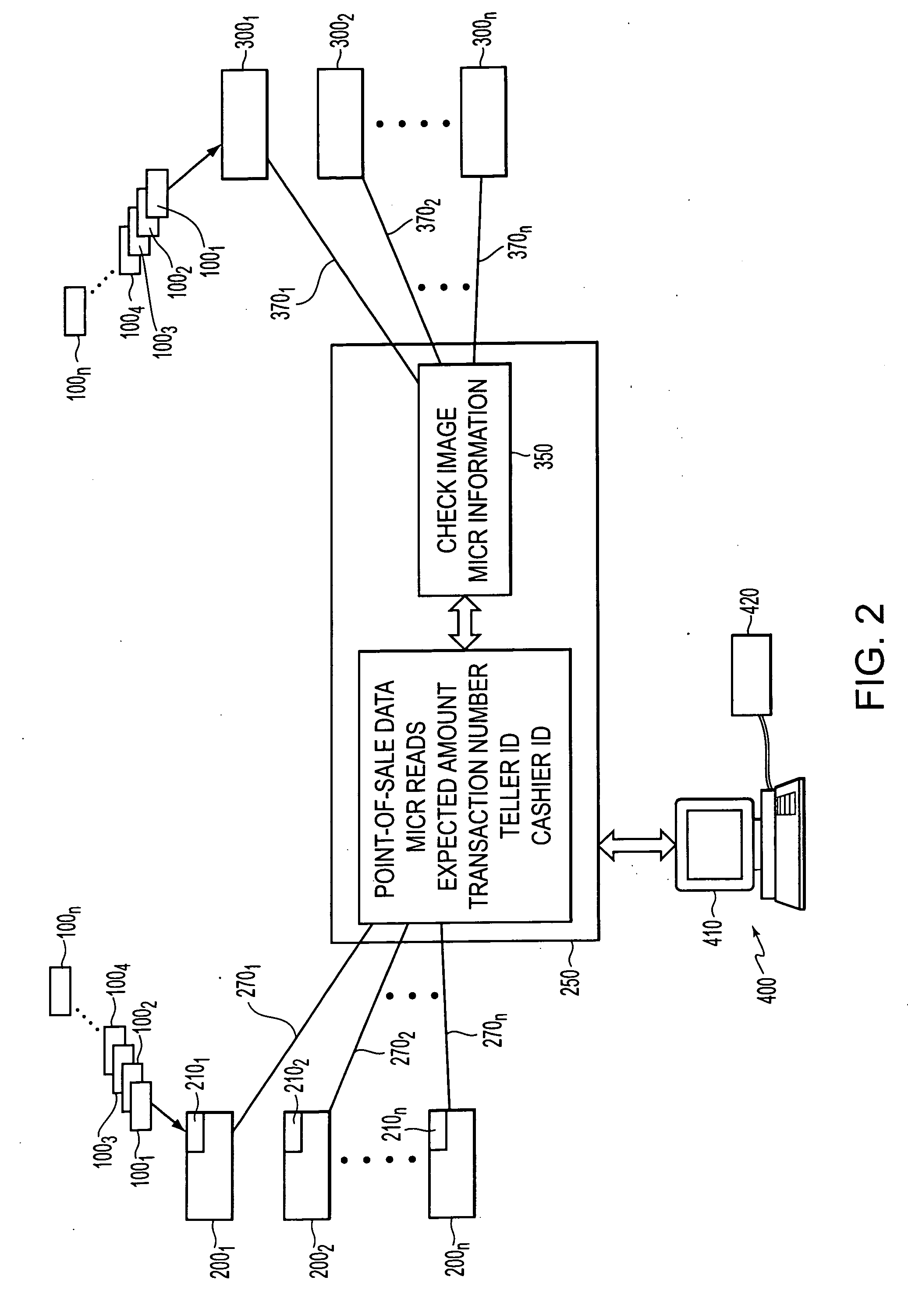

Method and apparatus for processing checks

ActiveUS20050108168A1Reduce physical activityImprove process integrityComplete banking machinesFinanceAlgorithmCheque

A check processing system and method comprising utilizes an image scanner that produces an electronic image of a check upon scanning of the check. The system and method receive the electronic image of the check from the image scanner, receive point-of-sale data generated at a point-of-sale, determine a monetary value of the check from the electronic image of the check, and reconcile the determined monetary value of the check with the point-of-sale data so that the check is correlated with a transaction that occurred at the point-of-sale.

Owner:TALARIS HLDG

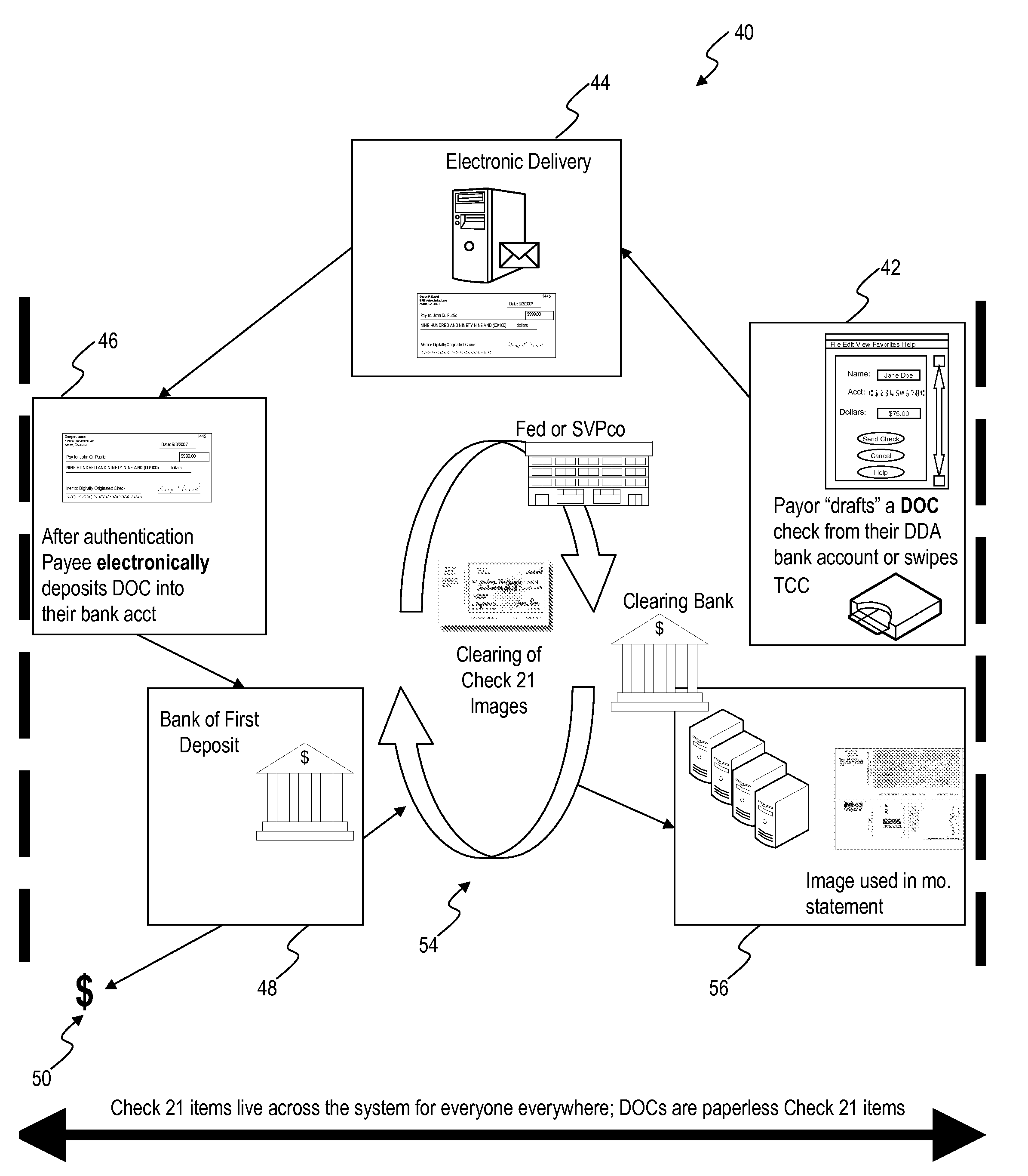

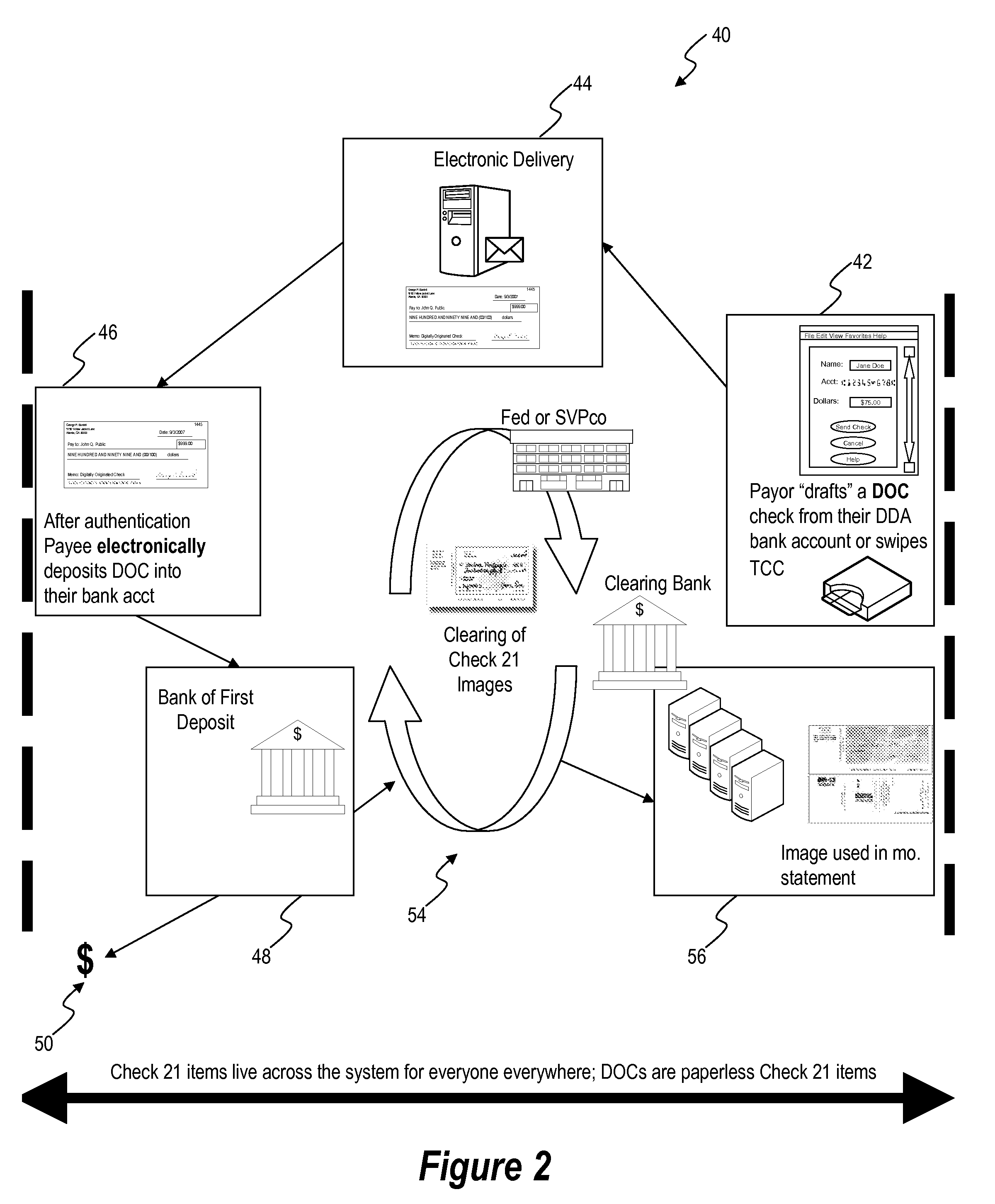

Electronic payment systems and methods utilizing digitally originated checks

The present invention provides a digitally originated check (DOC) through an electronic payment system (EPS) which captures payor metadata instructions regarding the intended payment to a payee. The metadata is stored in a database or the like for further processing instead of printing a paper check. The EPS is operable to clear the DOC through either paper or electronic Check 21 mechanisms.

Owner:GLOBAL STANDARD FINANCIAL

System and method for screening for fraud in commercial transactions

InactiveUS20070244782A1Prevent improper transactionFinancePaper-money testing devicesSystems analysisBank teller

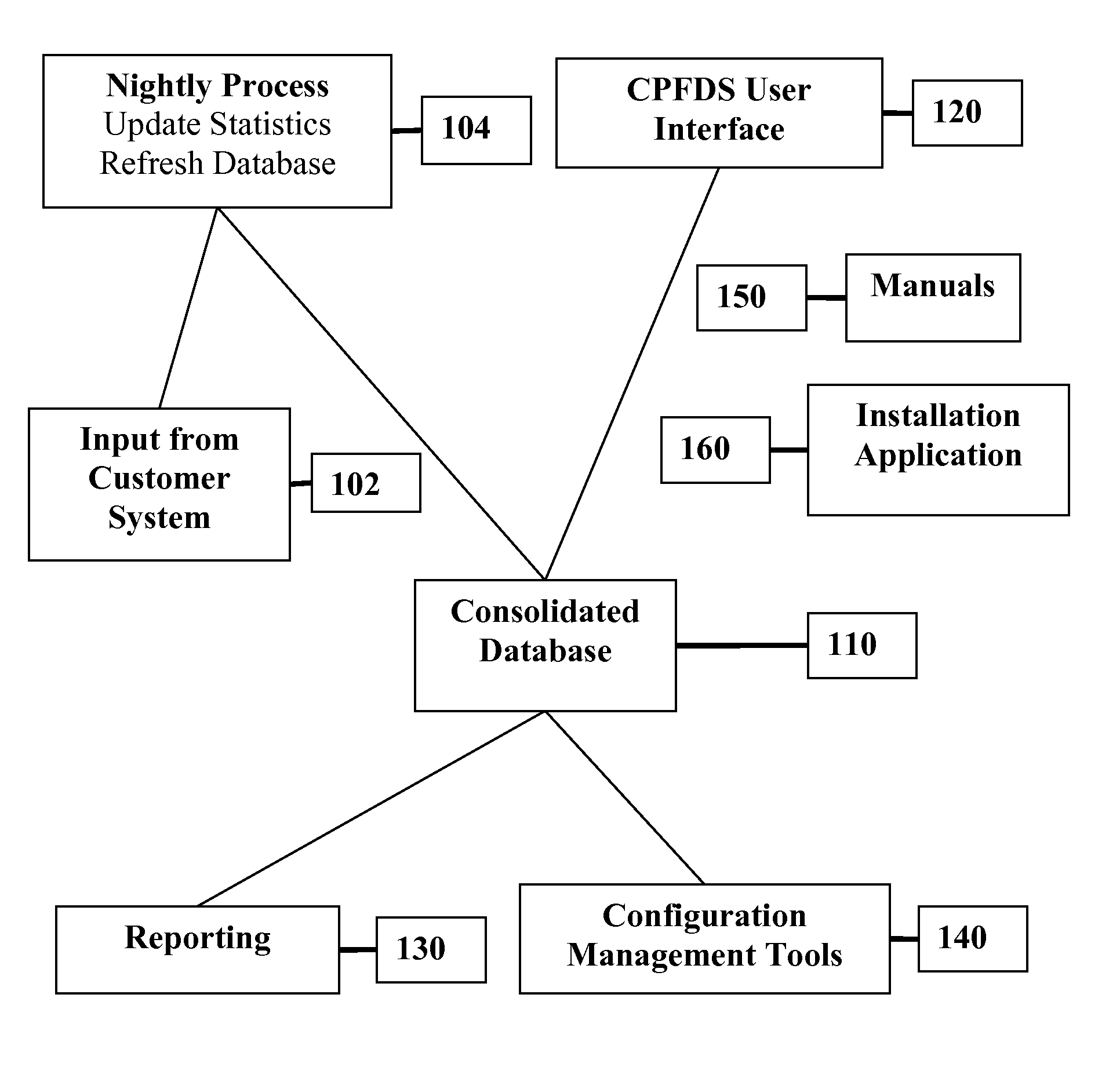

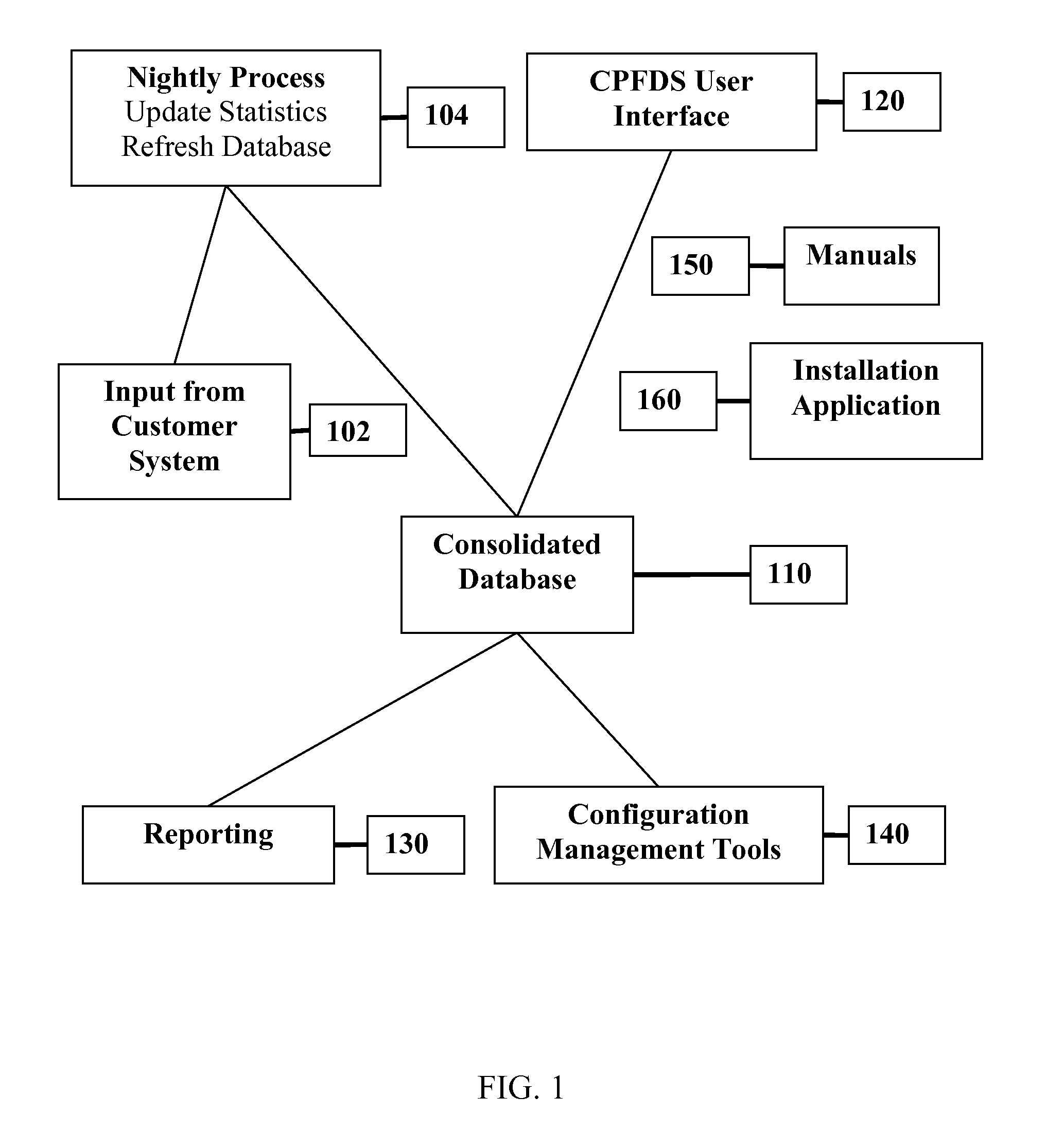

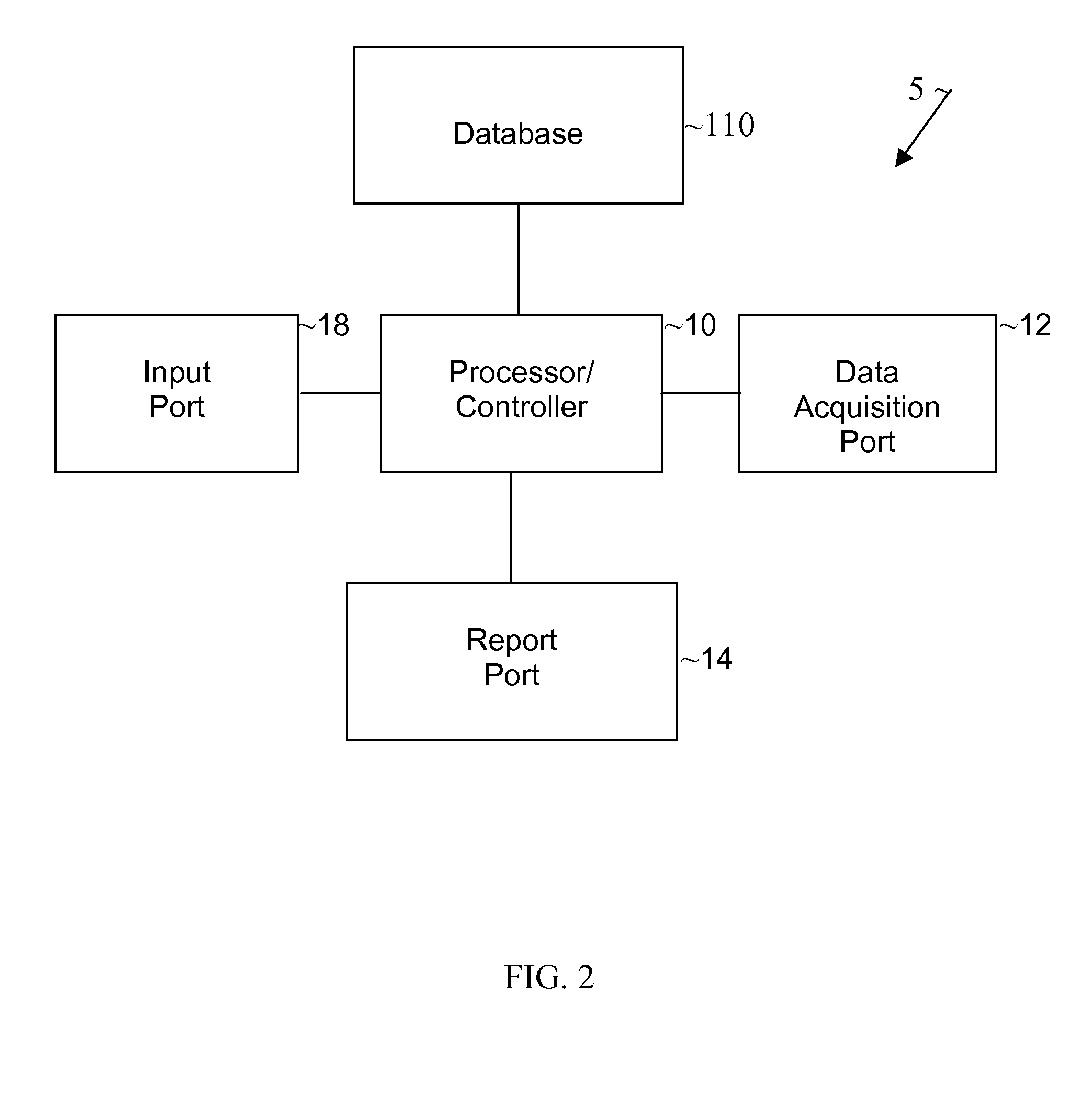

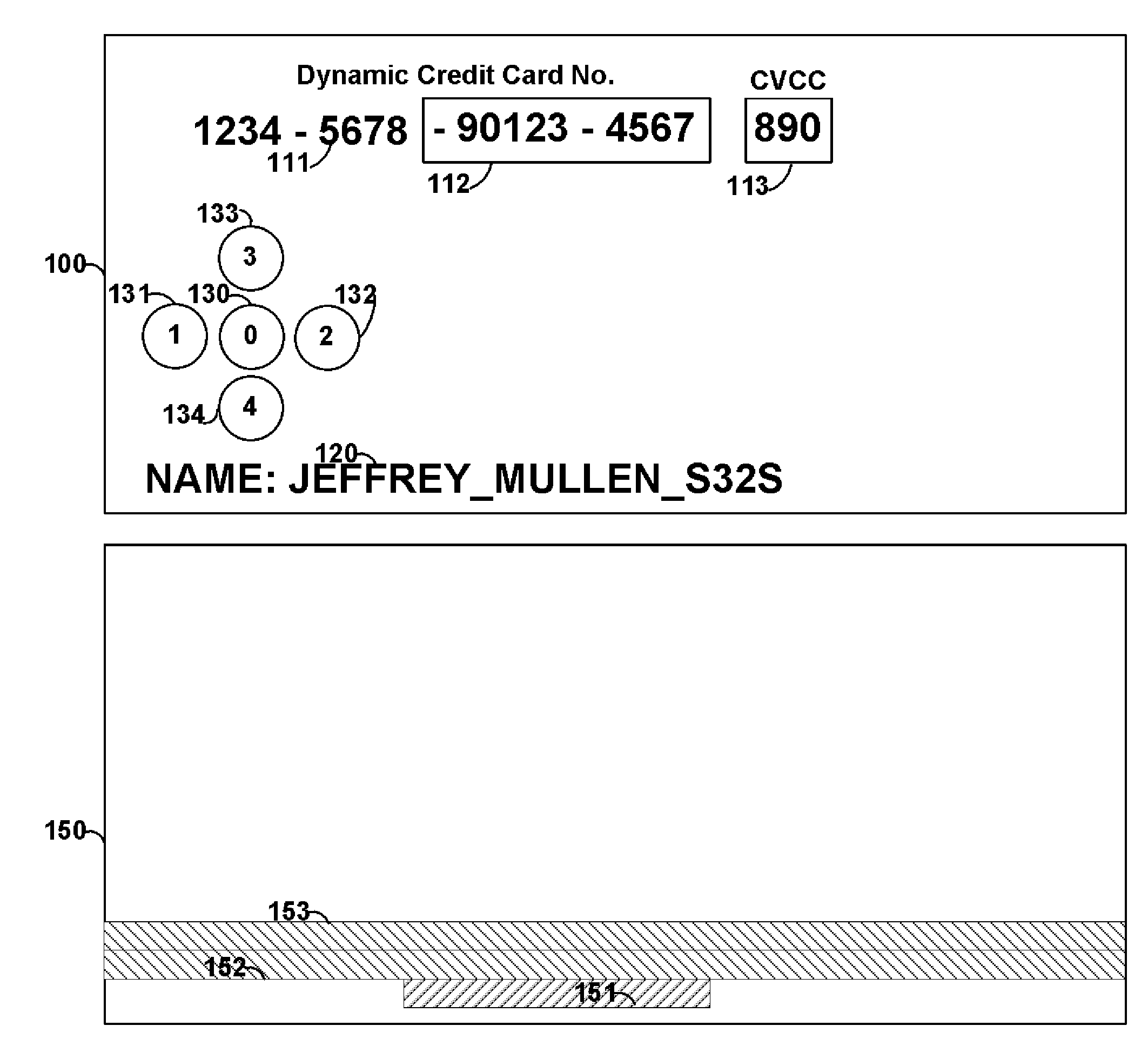

A method for screening for potential fraud in commercial paper is provided. For example, a method of the invention comprises steps of presenting a check for cashing to a check cashing agent (e.g., a bank teller); scanning or inspecting the check for data; selecting data for analysis; analyzing selected data with a commercial paper fraud detection system (“CPFDS”); and reporting results of the fraud detection system analysis to the check cashing agent. The commercial paper fraud detection system provides a means for predicting if commercial paper is potentially fraudulent. For example, the commercial paper fraud detection system may detect stolen checks, altered checks, and fabricated or counterfeit checks, among other types of fraud. Also provided is a computer program product for detecting fraud in commercial paper.

Owner:CHIMENTO MARC A

Payment cards and devices operable to receive point-of-sale actions before point-of-sale and forward actions at point-of-sale

PendingUS20090159663A1Shorten the timeEasy to changeImage enhancementImage analysisWaiters/waitressesUser input

A payment card or other device (e.g., mobile telephone) is provided with a magnetic emulator operable to communicate data to a magnetic stripe read-head. A user can utilize buttons located on the card to perform activities that would otherwise be performed at an ATM, payment card reader, or by a waitress. A user can provide instructions on a card to accelerate a transaction. The information a user enters can be communicated to a point-of-sale device. For example, a user can enter into his / her card that the user desires $100 withdrawal from a checking account. The user can also enter his / her PIN into the card. The user can swipe his / her card into an ATM and instantly be provided with the desired $100.

Owner:DYNAMICS

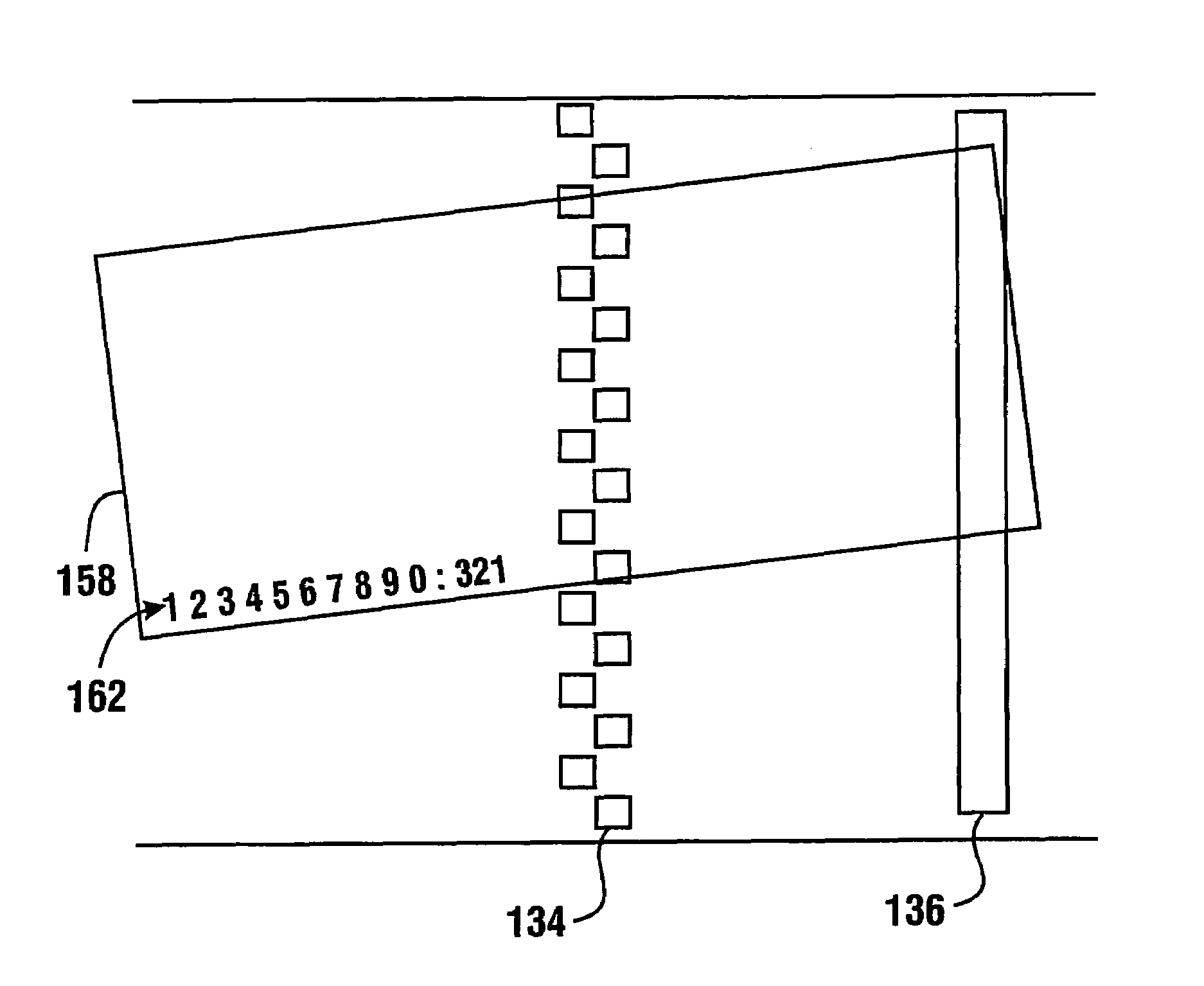

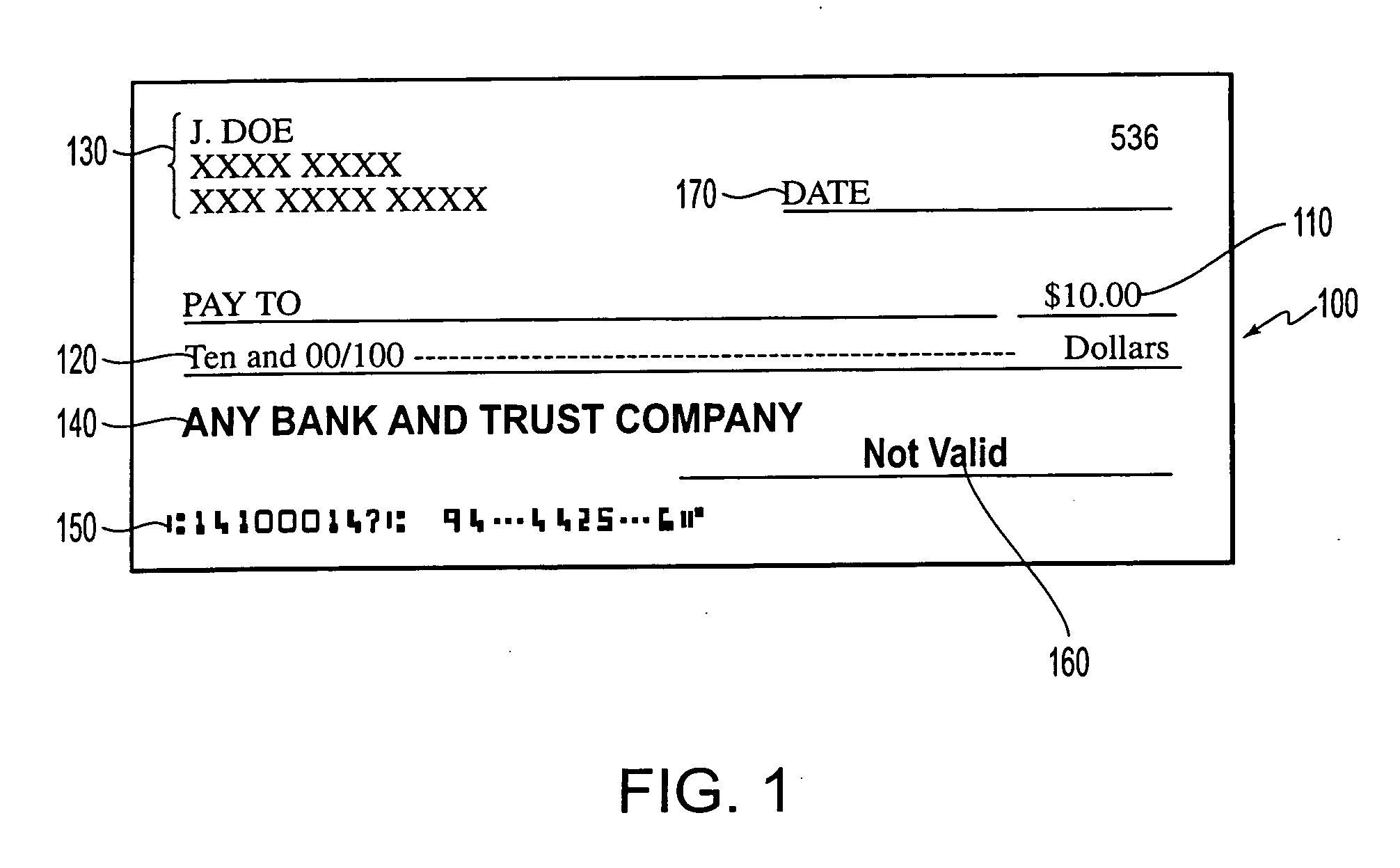

ATM check invalidation and return systems and methods

Systems, methods, and software are described for check processing at an ATM. A check may be received at an ATM, and an image of the check may be captured. It may then be verified that the image captured meets an established quality standard. The ATM may then print on the check to indicate that it is not negotiable, and the check may be discharged from the ATM to the user.

Owner:FIRST DATA

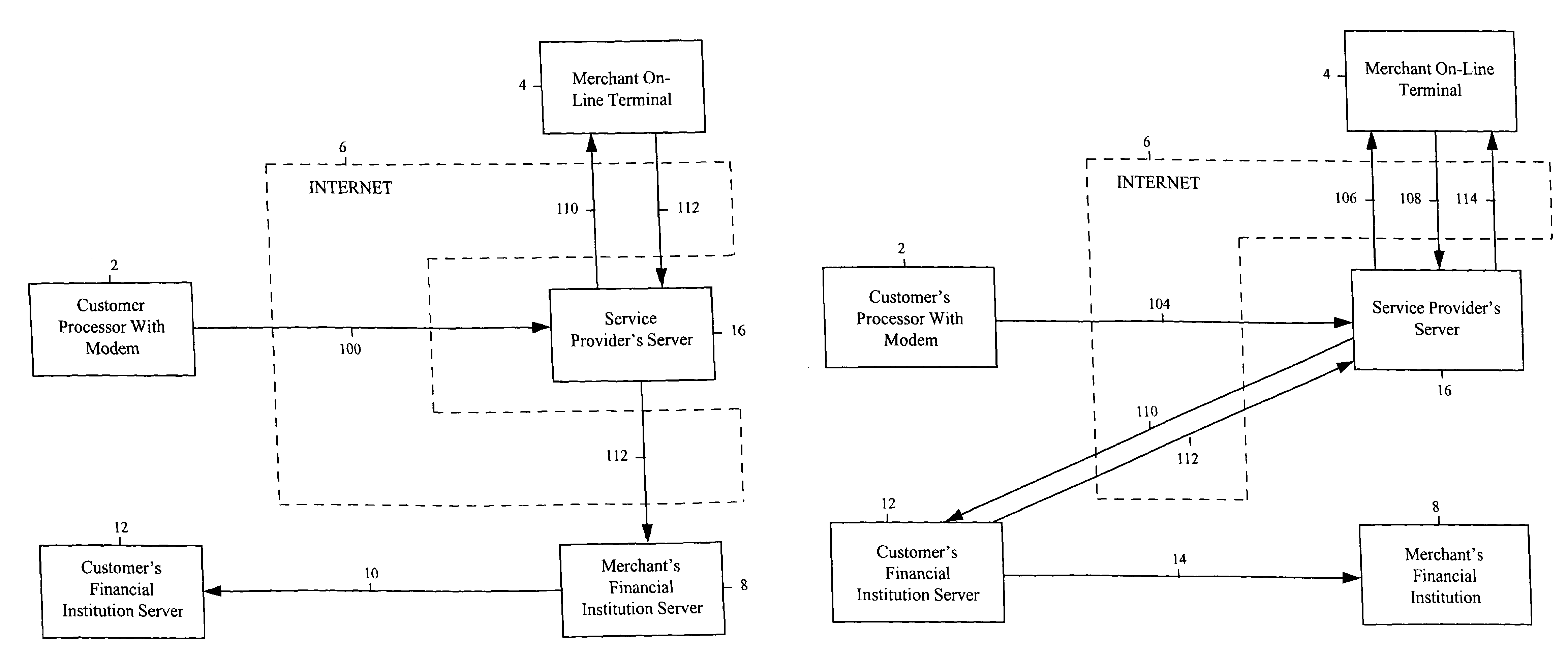

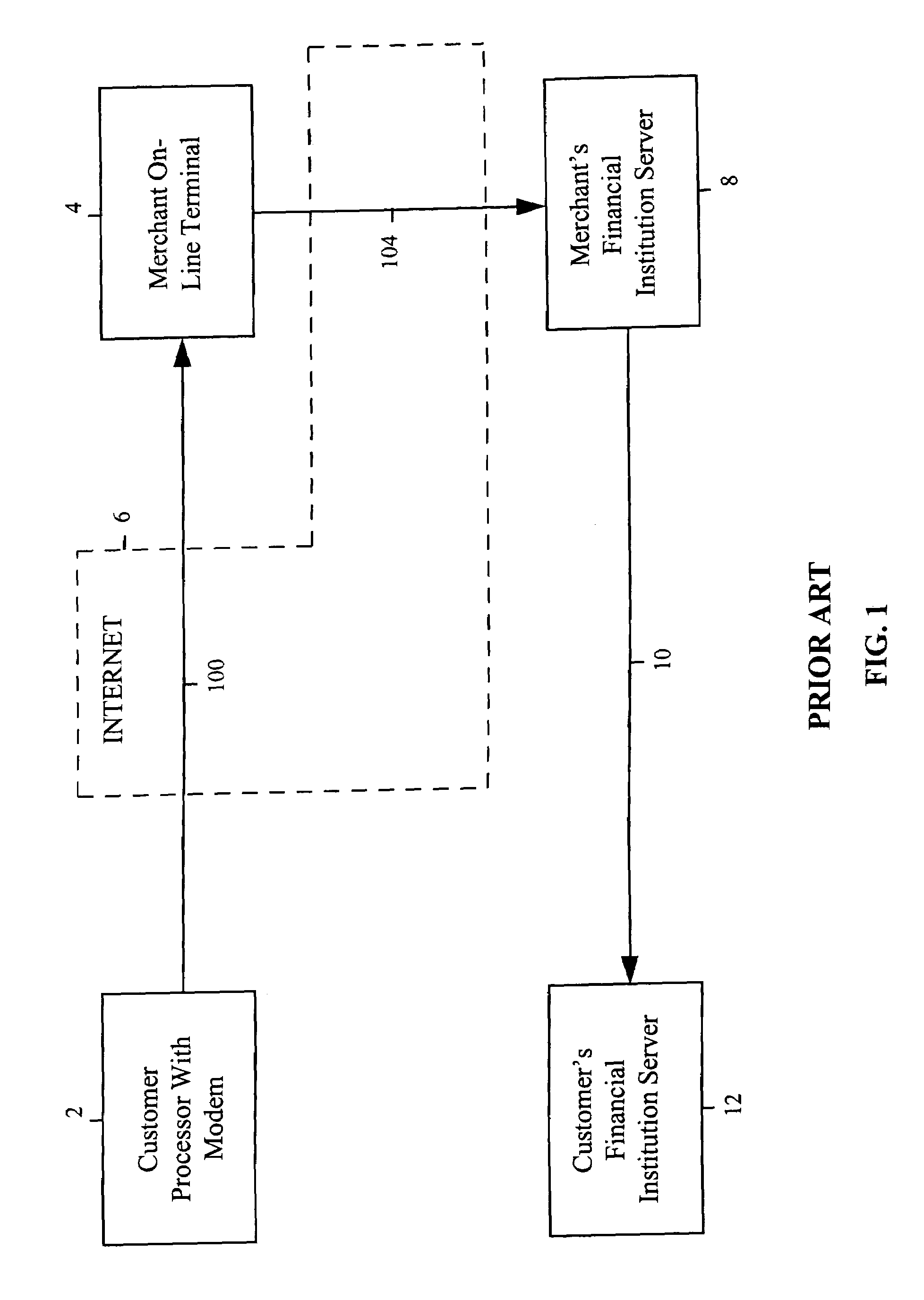

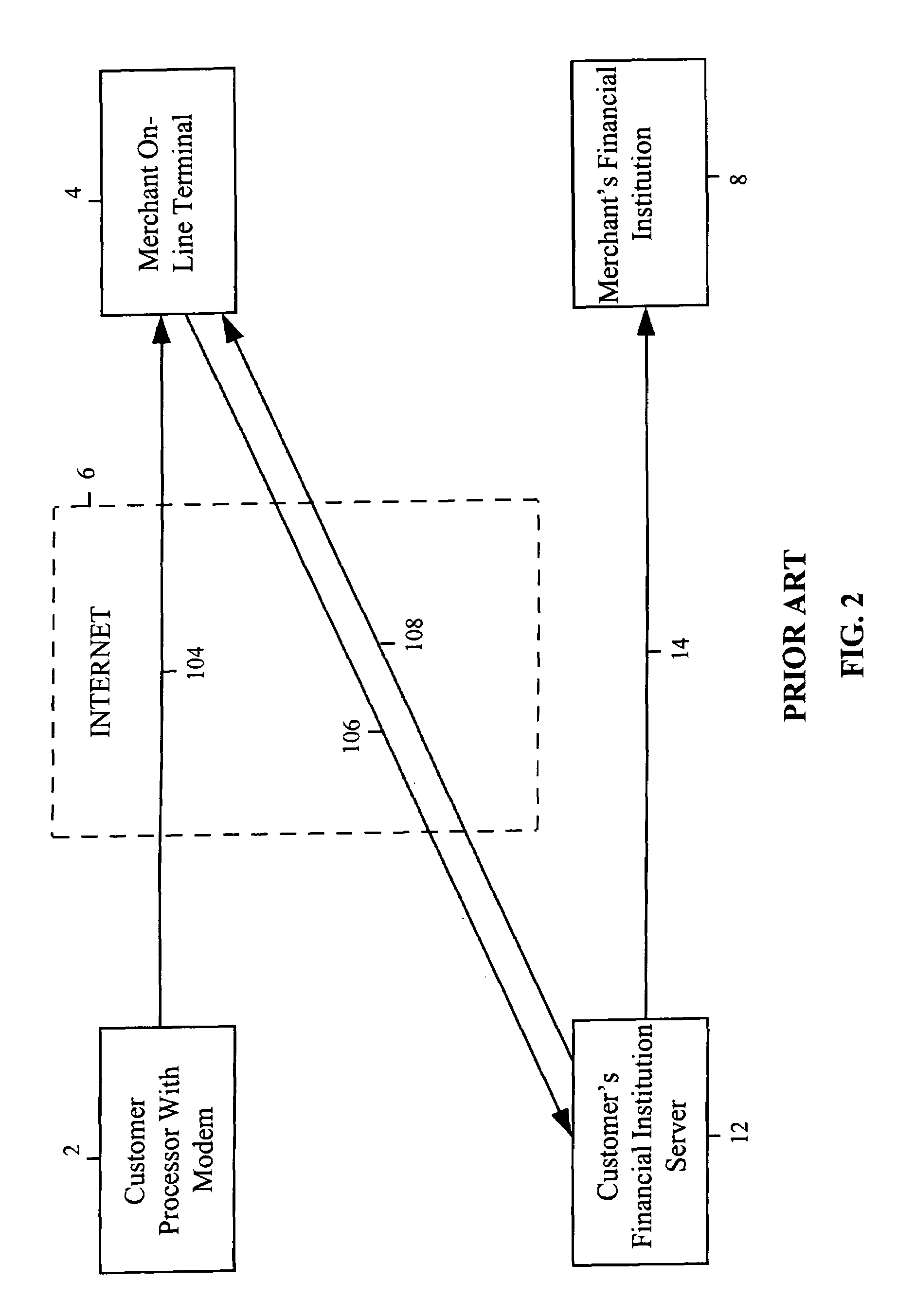

System and method for merchant function assumption of internet checking and savings account transactions

InactiveUS7051001B1Reduce transaction costsSave transaction costFinanceBilling/invoicingPaymentService provision

A system and method for merchant function assumption of Internet checking and savings account transactions enables a service provider to take over all merchant type transactions and provide a merchant, such as an Internet merchant, with an approved order and appropriate credit for the transaction. A service provider server receives an electronic check or a payment instruction for the merchant from a customer. The payment instruction includes, for example, the originator's digital certificate and payment and purchase information, including the originator's checking or savings account number. The payment instruction is automatically sent to a customer's bank's server, which confirms the availability of funds for the payment. A confirmation of the availability of funds is automatically sent to the merchant, and a credit for the payment is automatically sent to the merchant's account. In addition, the service provider can consolidate order and settlement transactions, which saves transaction costs for the merchant.

Owner:CITIBANK

Systems and methods for assessing the risk of a financial transaction using reconciliation information

InactiveUS20050125338A1Accurate descriptionSlow processFinancePayment architectureChequeFinancial transaction

Systems and methods are described for better assessing risk associated with cashing second-party checks and other negotiable instruments using positive pay or other reconciliation information about a check presented for cashing. Positive pay information, which may be made available by a check issuer, provides a list of checks that have been, for example, issued and not yet cashed, already cashed, voided, stolen, and the like, thus providing an indication of whether the check issuer is willing to honor the checks. In various embodiments, positive pay information about a check may be expressed as a gradated positive pay risk score. In various embodiments, the positive pay risk score may be combined with risk scores that are descriptive of other aspects of the check cashing transaction to calculate a risk score for the transaction as a whole. In some embodiments, the risk scores may be used to generate an accept / decline recommendation for the transaction as a whole.

Owner:FIRST DATA

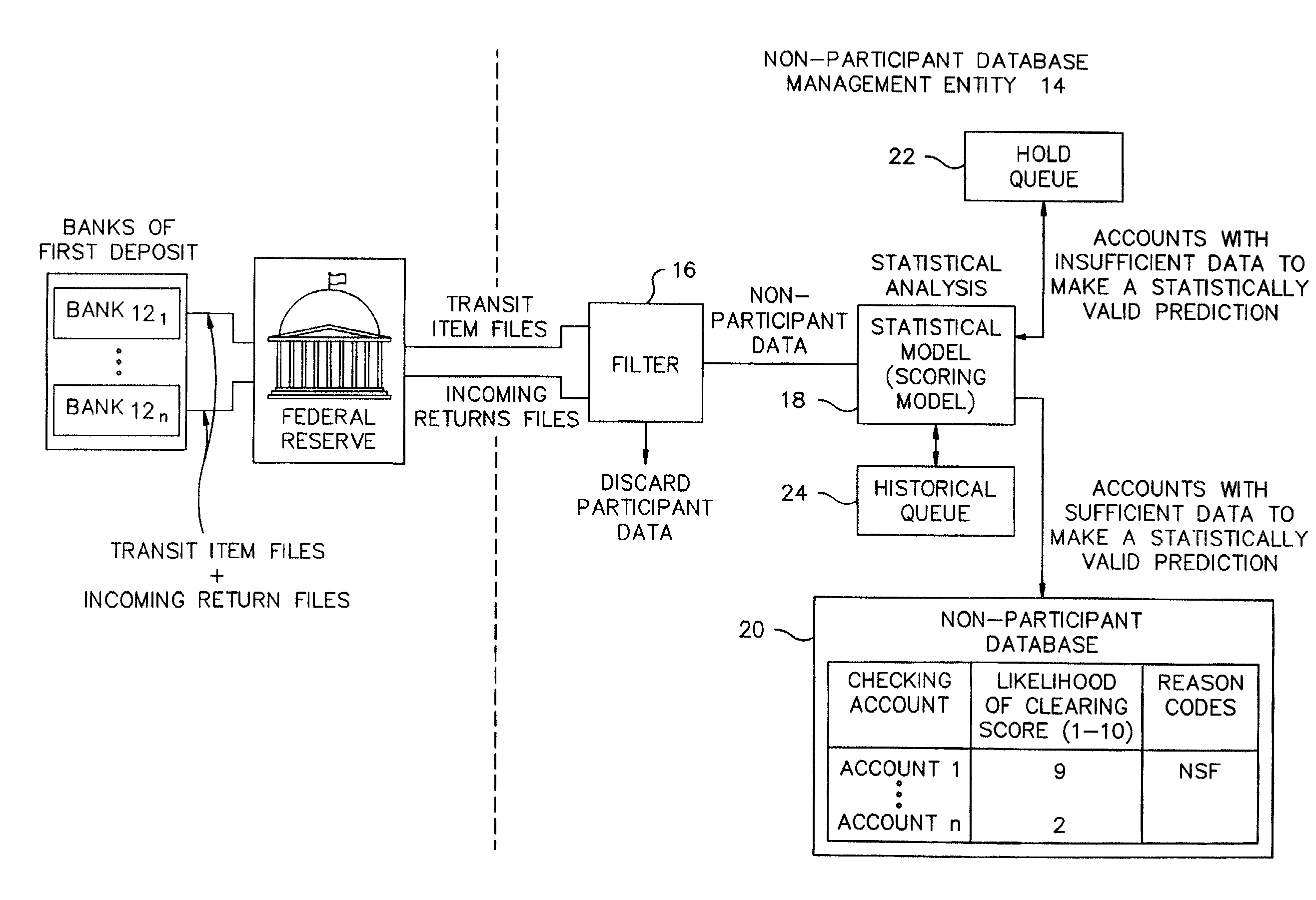

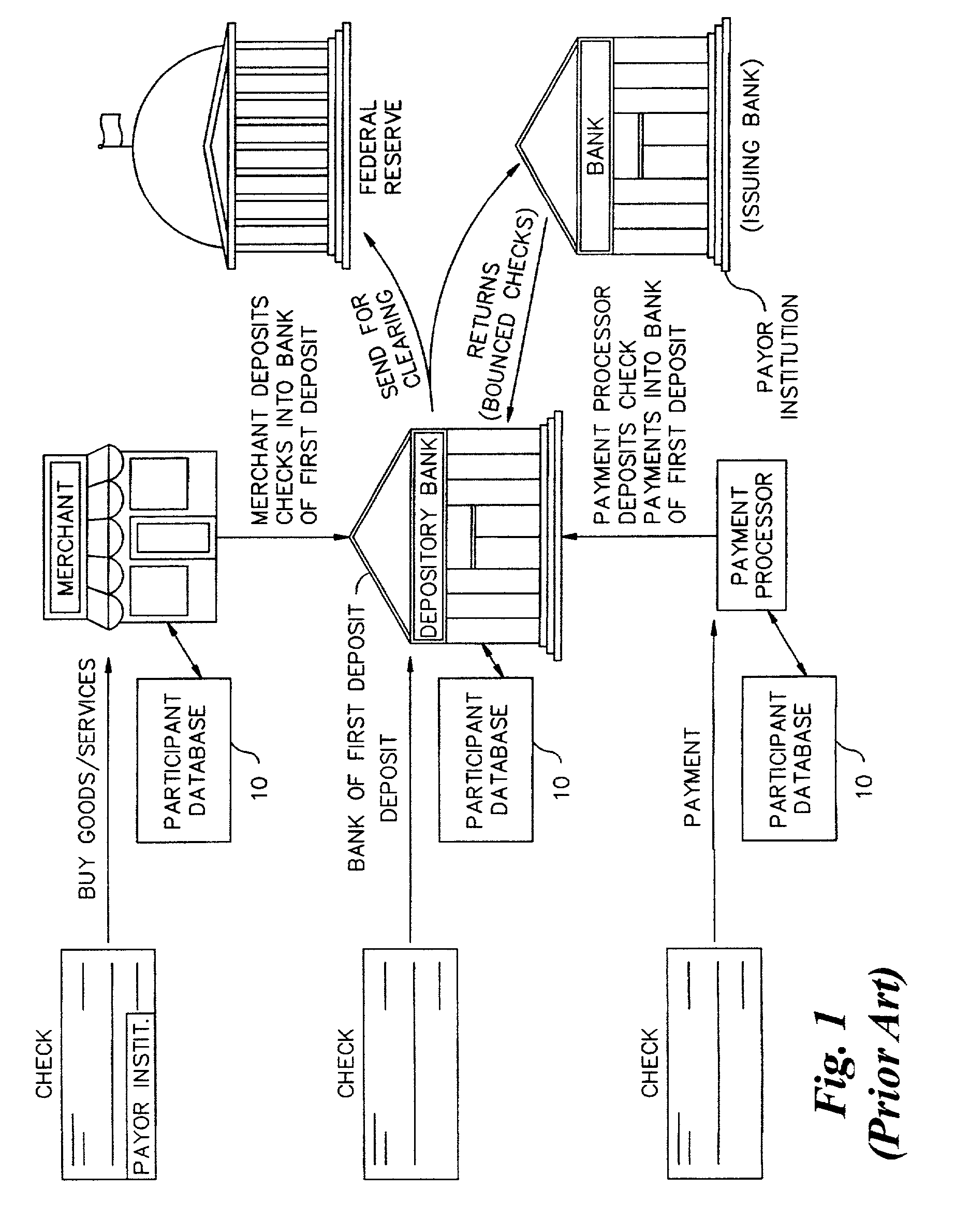

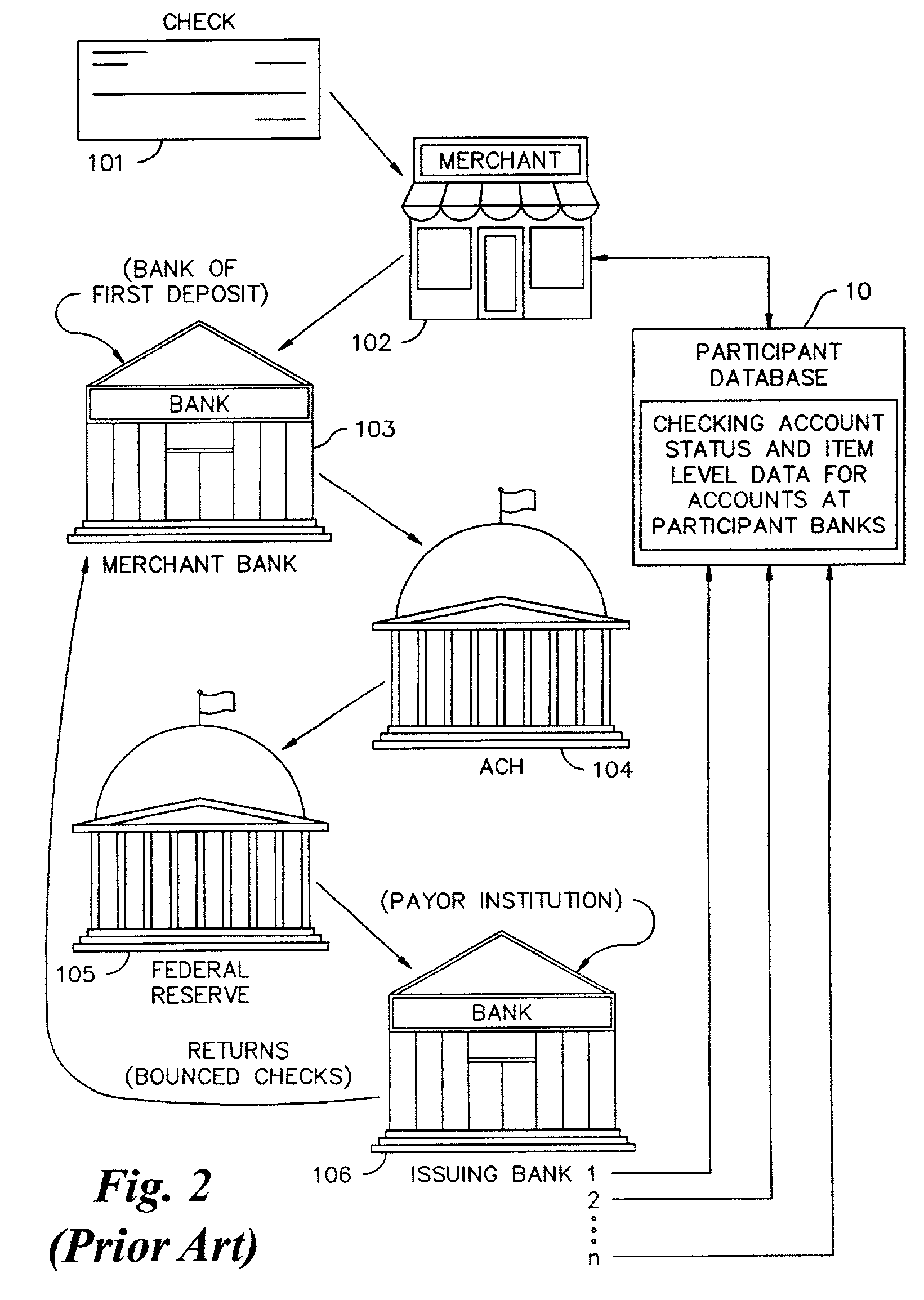

Database for check risk decisions populated with check activity data from banks of first deposit

A plurality of banks of first deposit provide checking account activity data for both transit items (checks received for deposit that need to be cleared) and incoming returns (bounced checks) to a statistical model which determines from the data the likelihood that a check from a specific checking account will be returned. This data is used to populate a database of checking accounts to be used for making check risk decisions, such as check hold policy decisions, check acceptance decisions, and open to buy decisions.

Owner:EARLY WARNING SERVICES

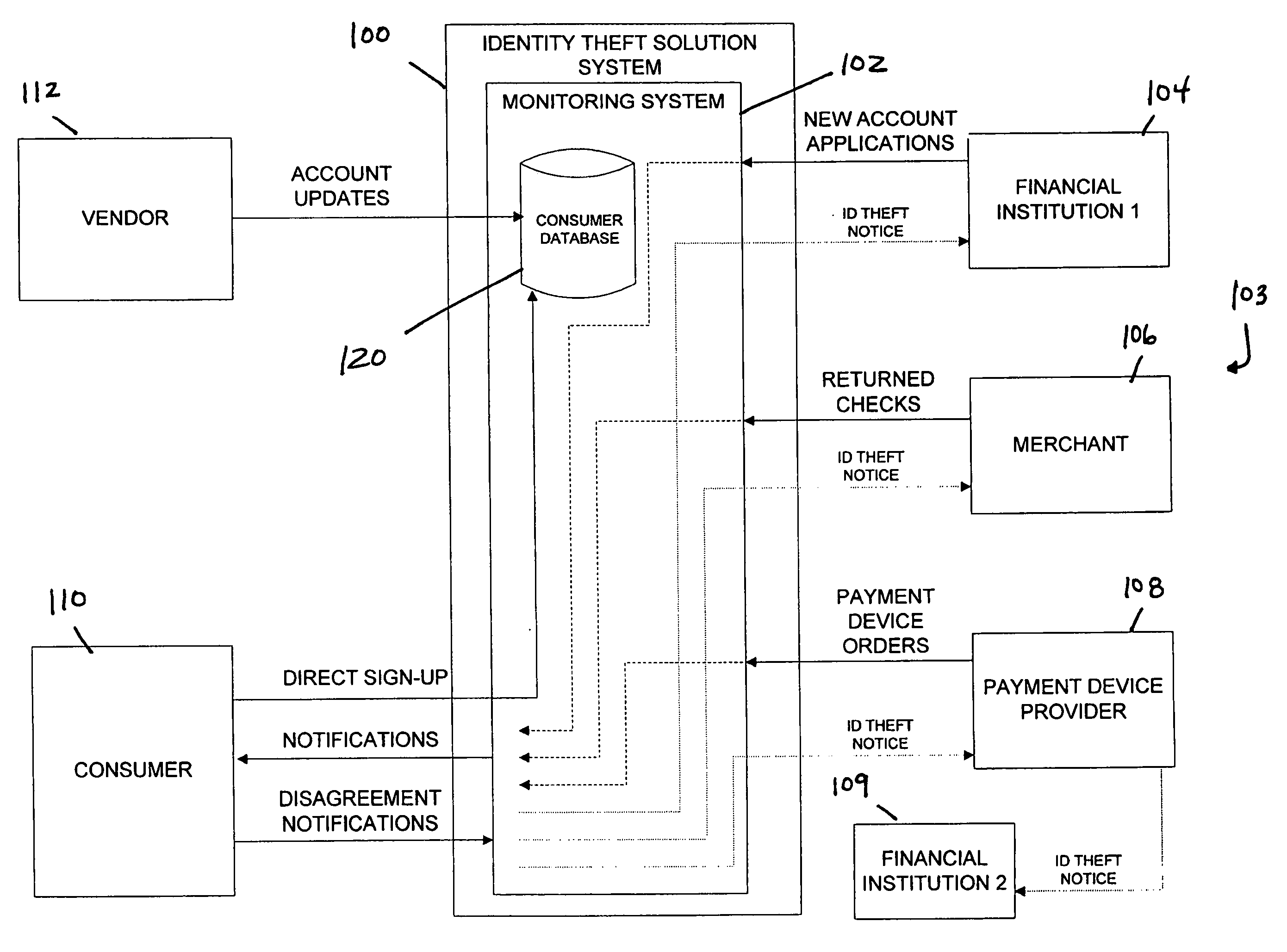

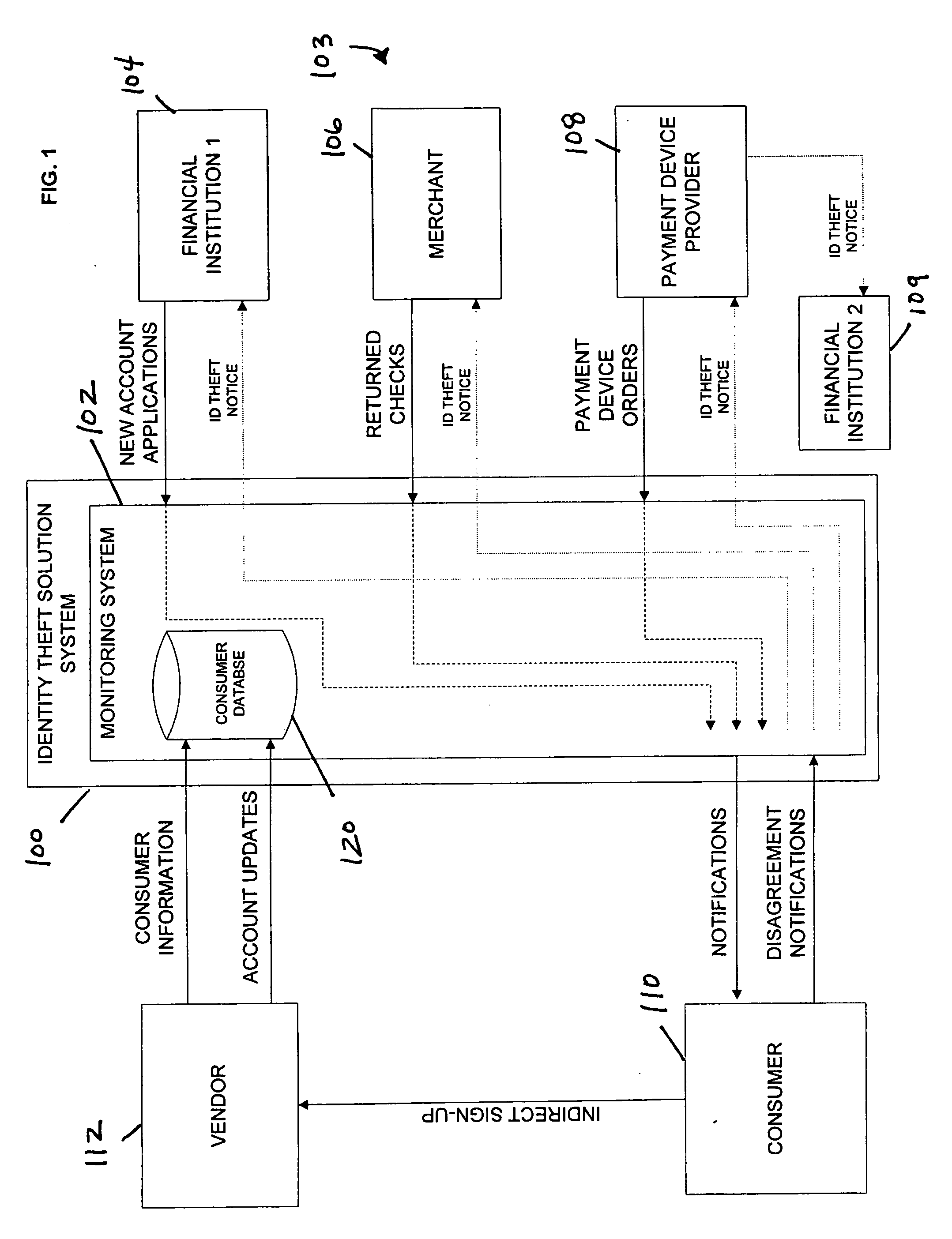

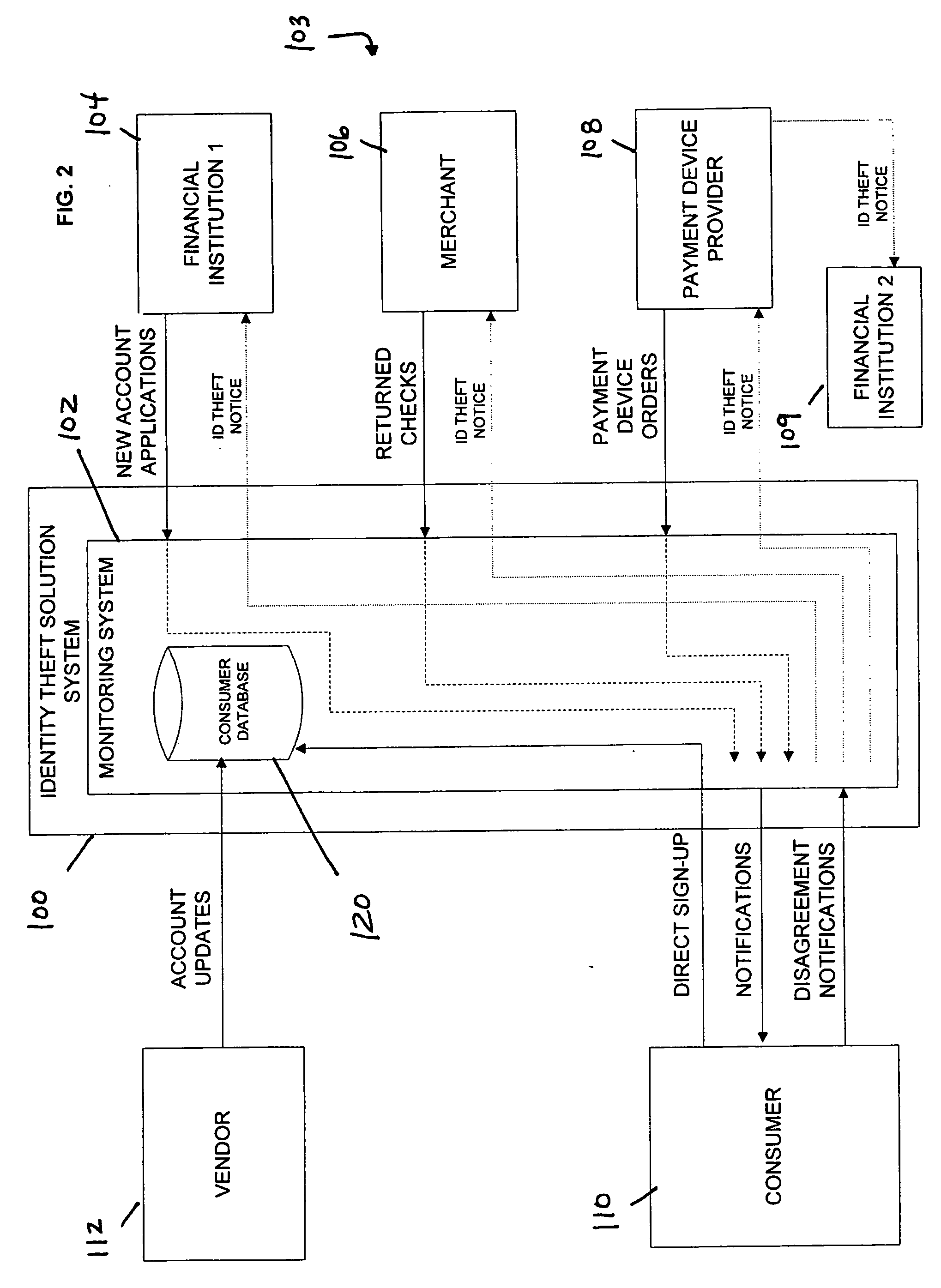

Debit-based identity theft monitoring and prevention

ActiveUS20060271456A1Prevent and limit potential financialPrevent and limit and reputation lossFinancePayment architectureIdentity theftCheque

Systems and methods of monitoring financial information of a consumer for fraudulent activity. One method can include receiving an account closure event from an event provider, determining if the account closure event is associated with financial information of the consumer, generating a notification, and providing the notification to the consumer. Another method can include receiving a returned check event from an event provider, determining if the returned check event is associated with financial information of the consumer, generating a notification, and providing the notification to the consumer.

Owner:FIDELITY INFORMATION SERVICES LLC

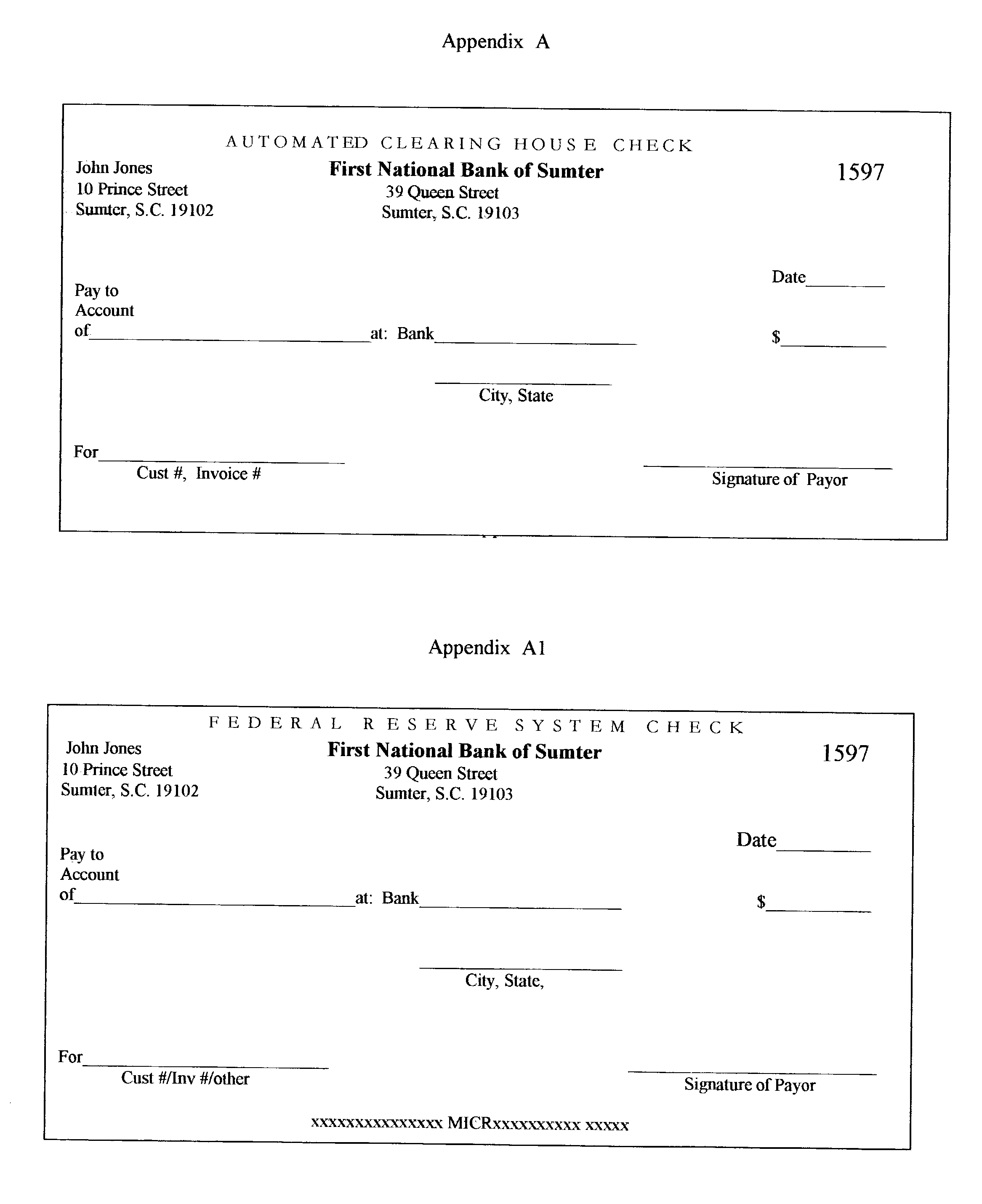

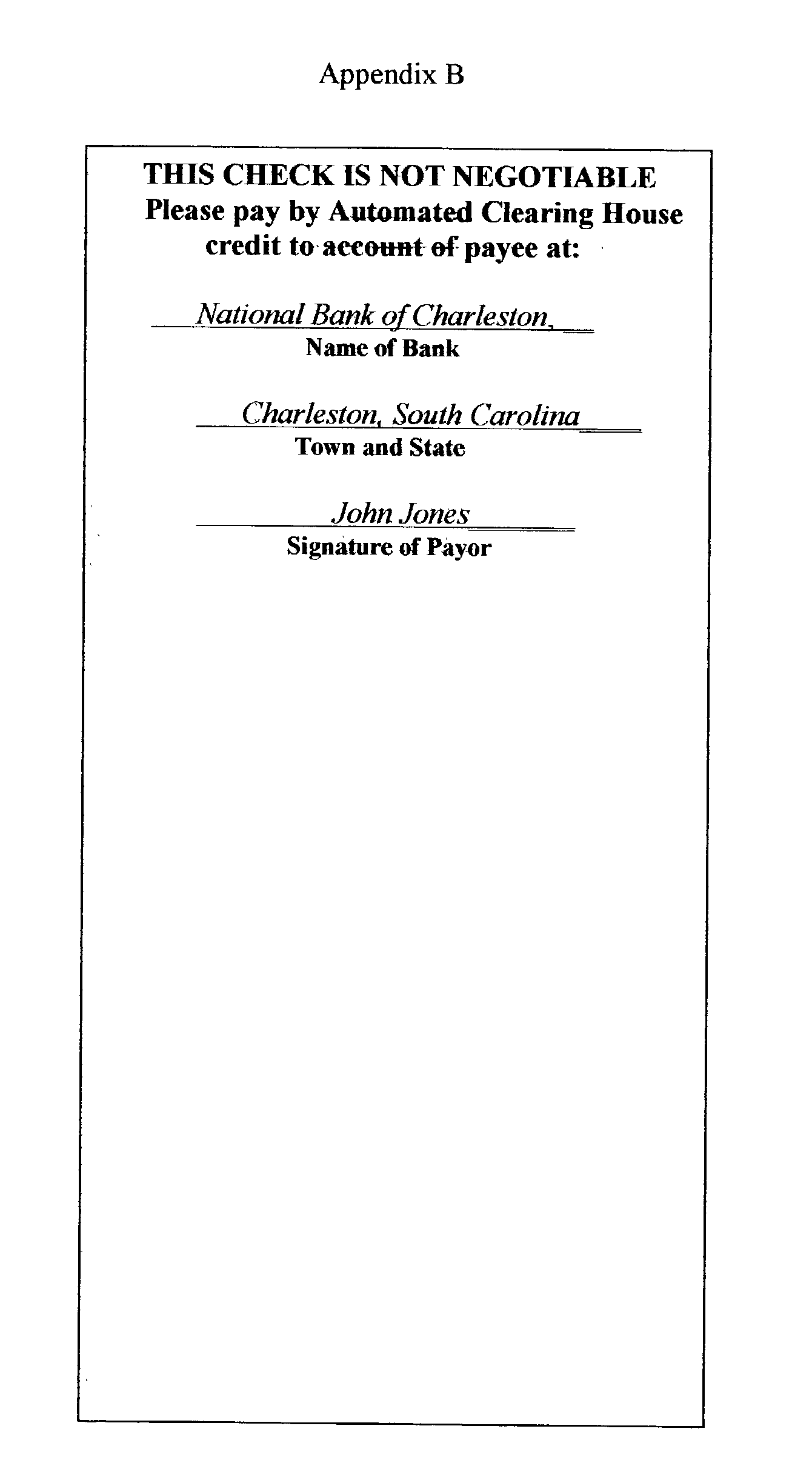

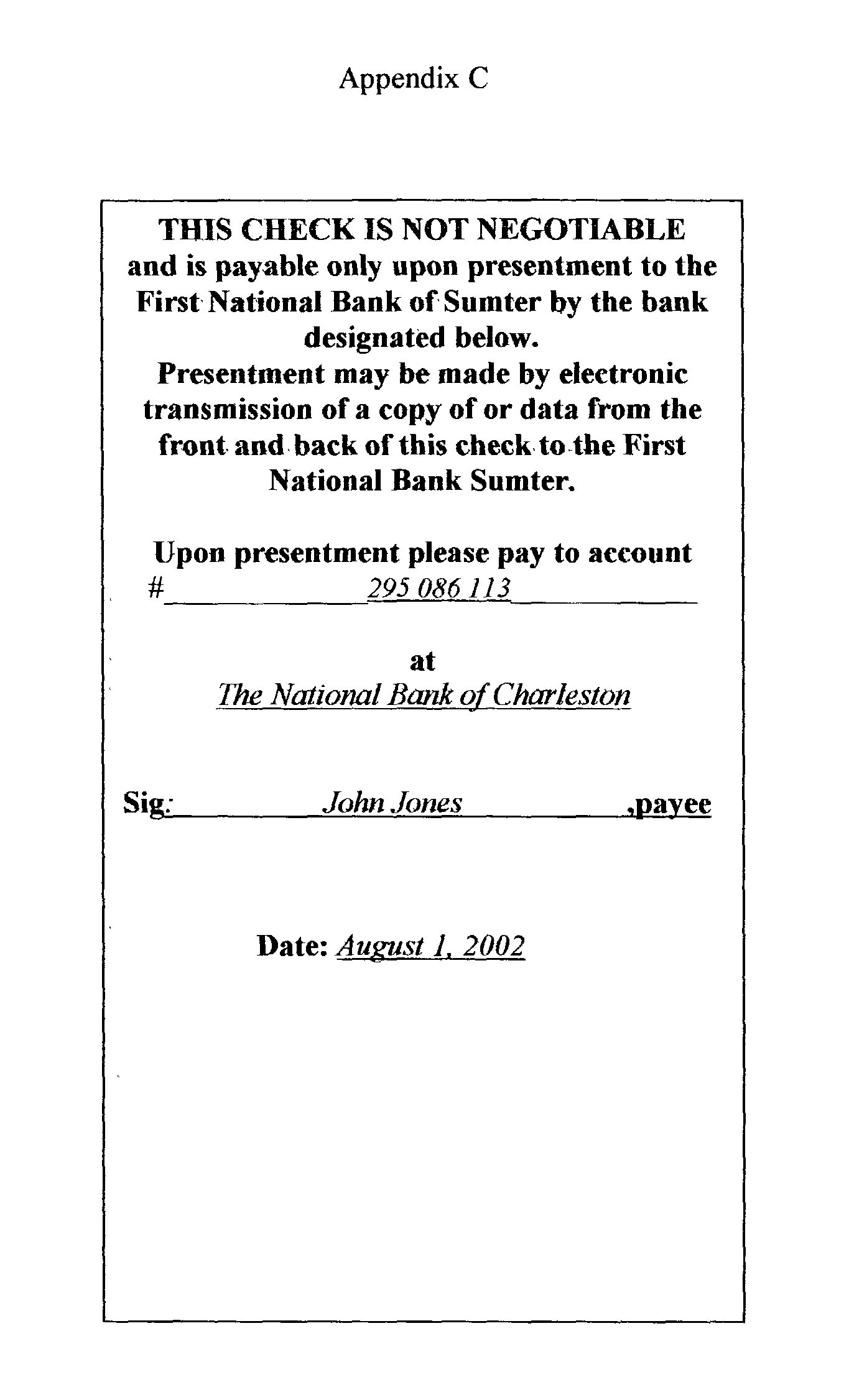

Method of making money payments

The system disclosed is for making payments using a new type of bank check combined with electronic funds transfer (EFT) facilities The new type check is not a negotiable instrument and is intended for delivery to the payor's bank rather than to the payee. The check instructs the payor's bank to make a payment by EFT from the payor's bank account directly to the bank account of the payee at the payee's bank, normally via the Federal Reserve's Automated Clearing House (ACH) facility. The system includes means for making a true, but inoperative, copy of each check at the time the check is written. Other embodiments of the invention are special checks, which look like conventional checks, but on their reverse sides display printed matter stating that they are non-negotiable and are payable only pursuant to special procedures.

Owner:ALLAN FREDERICK ALEY

Electronic Check

An electronic check that is created by a secure electronic transmission which can be printed as a paper check by the payee. The electronic check is created by a software program that makes a digital image of the check, securely encrypts the digital image and transmits the digital image to the payee. The payee then uses special software to decrypt the transmitted check image, which is then capable of being printed as a paper check by the payee. The payee can deposit the paper check to the bank. Optionally, the payee can electronically transmit the check image to the payee's bank.

Owner:ECHECK21

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com