Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

222 results about "Merchant account" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

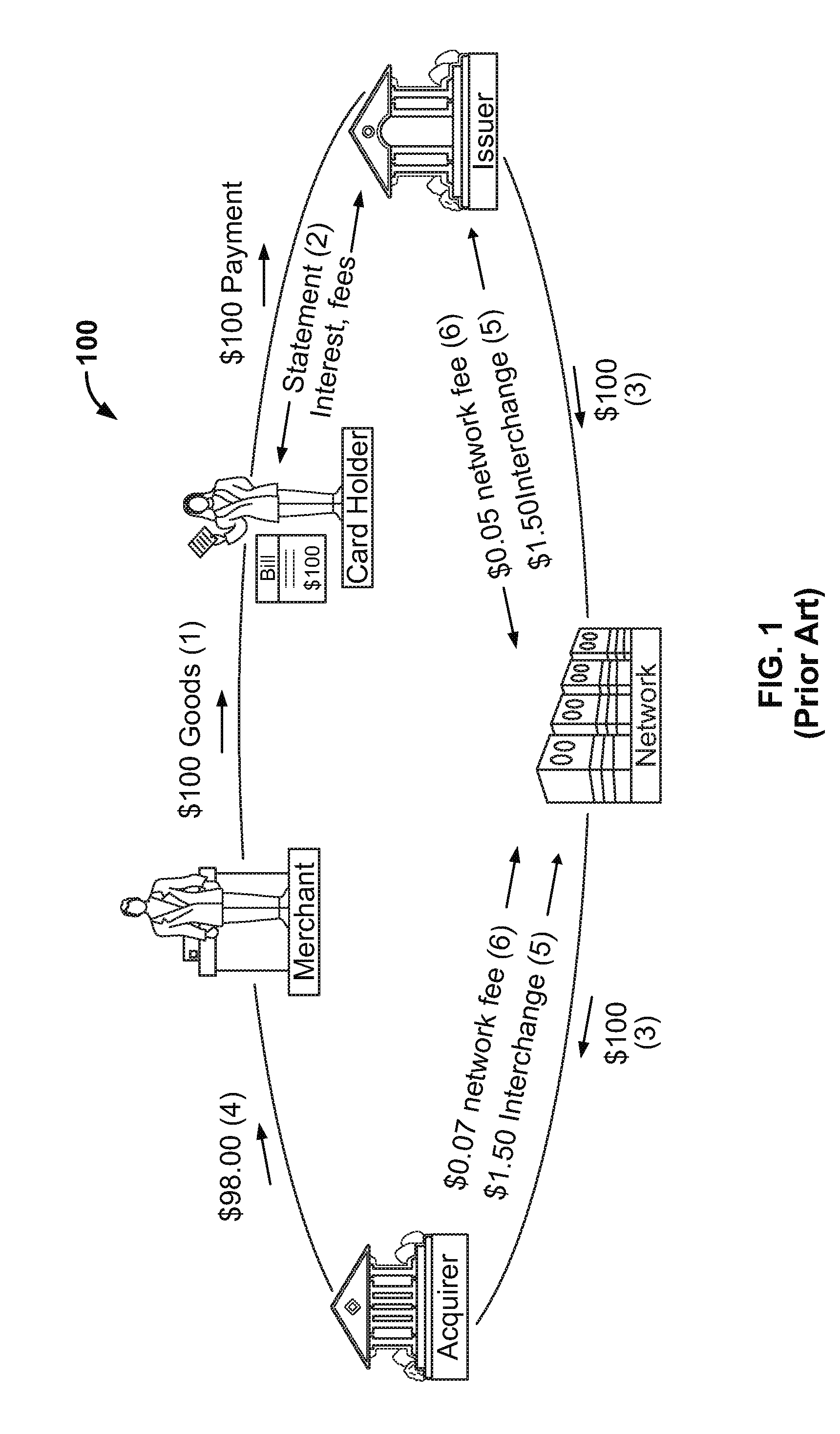

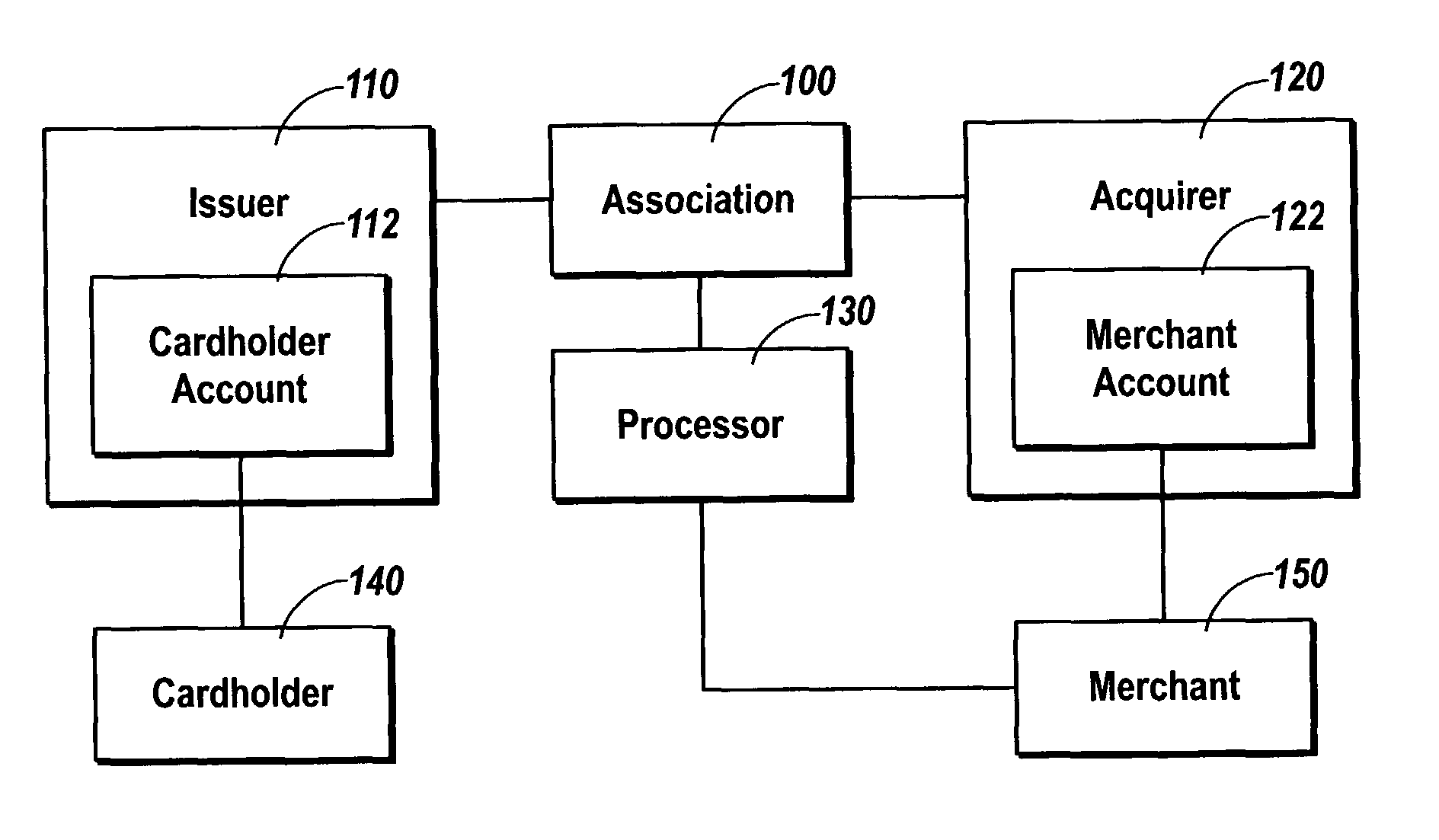

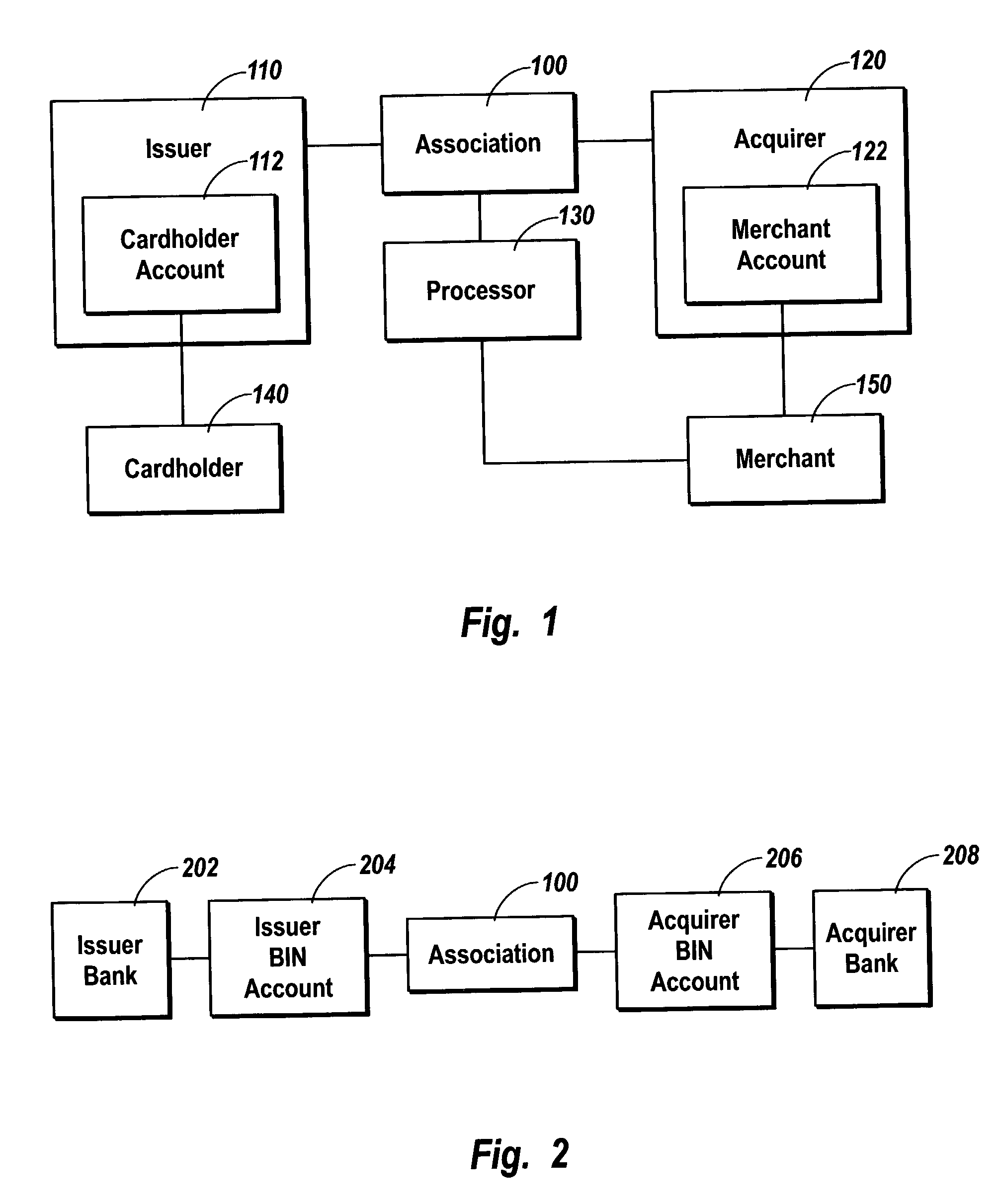

A merchant account is a type of bank account that allows businesses to accept payments in multiple ways, typically debit or credit cards. A merchant account is established under an agreement between an acceptor and a merchant acquiring bank for the settlement of payment card transactions. In some cases a payment processor, independent sales organization (ISO), or member service provider (MSP) is also a party to the merchant agreement. Whether a merchant enters into a merchant agreement directly with an acquiring bank or through an aggregator, the agreement contractually binds the merchant to obey the operating regulations established by the card associations.

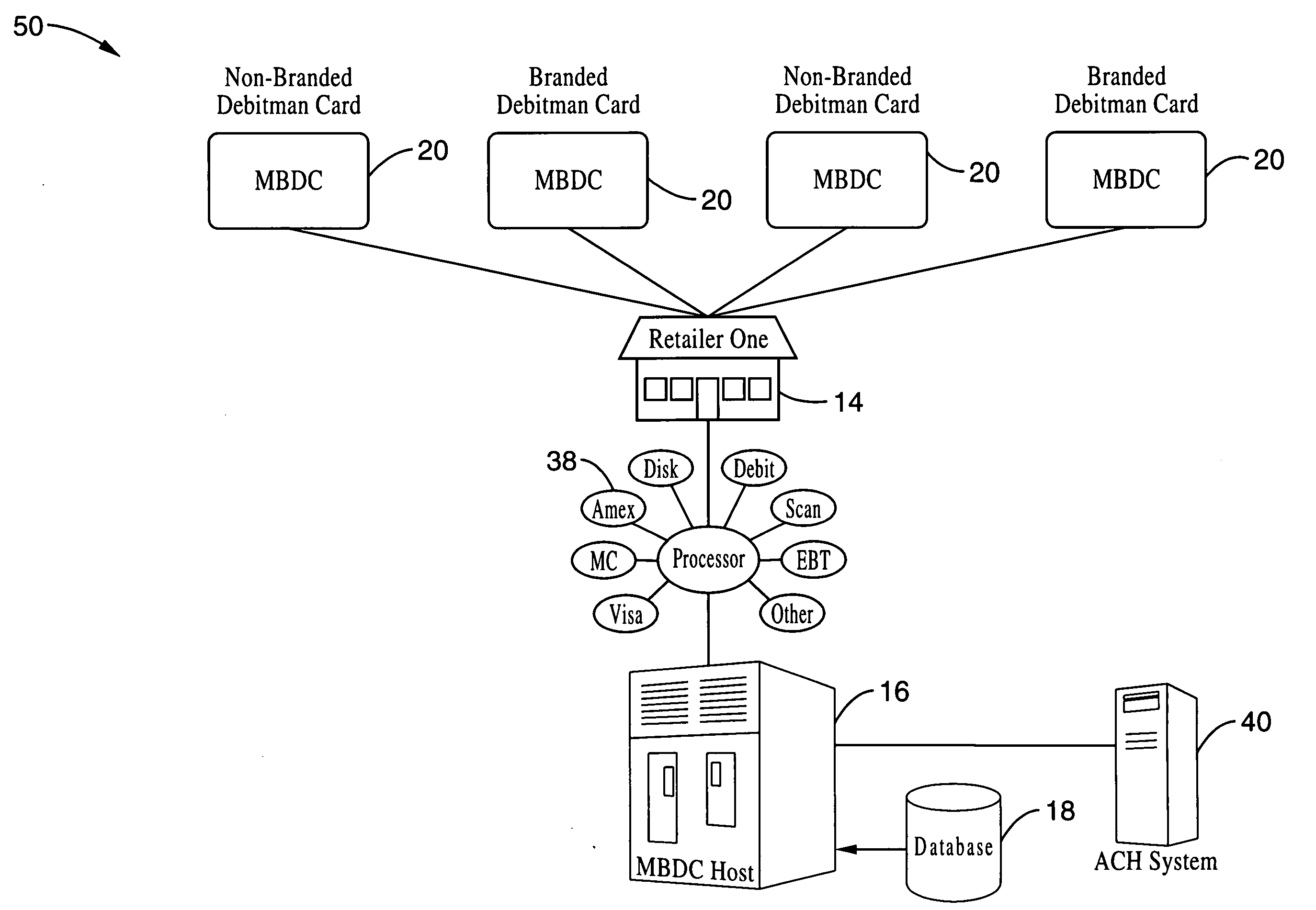

Method and system for facilitating electronic funds transactions

InactiveUS7104443B1Measurement is limitedReduce transaction costsComplete banking machinesFinanceInformation sharingMerchant account

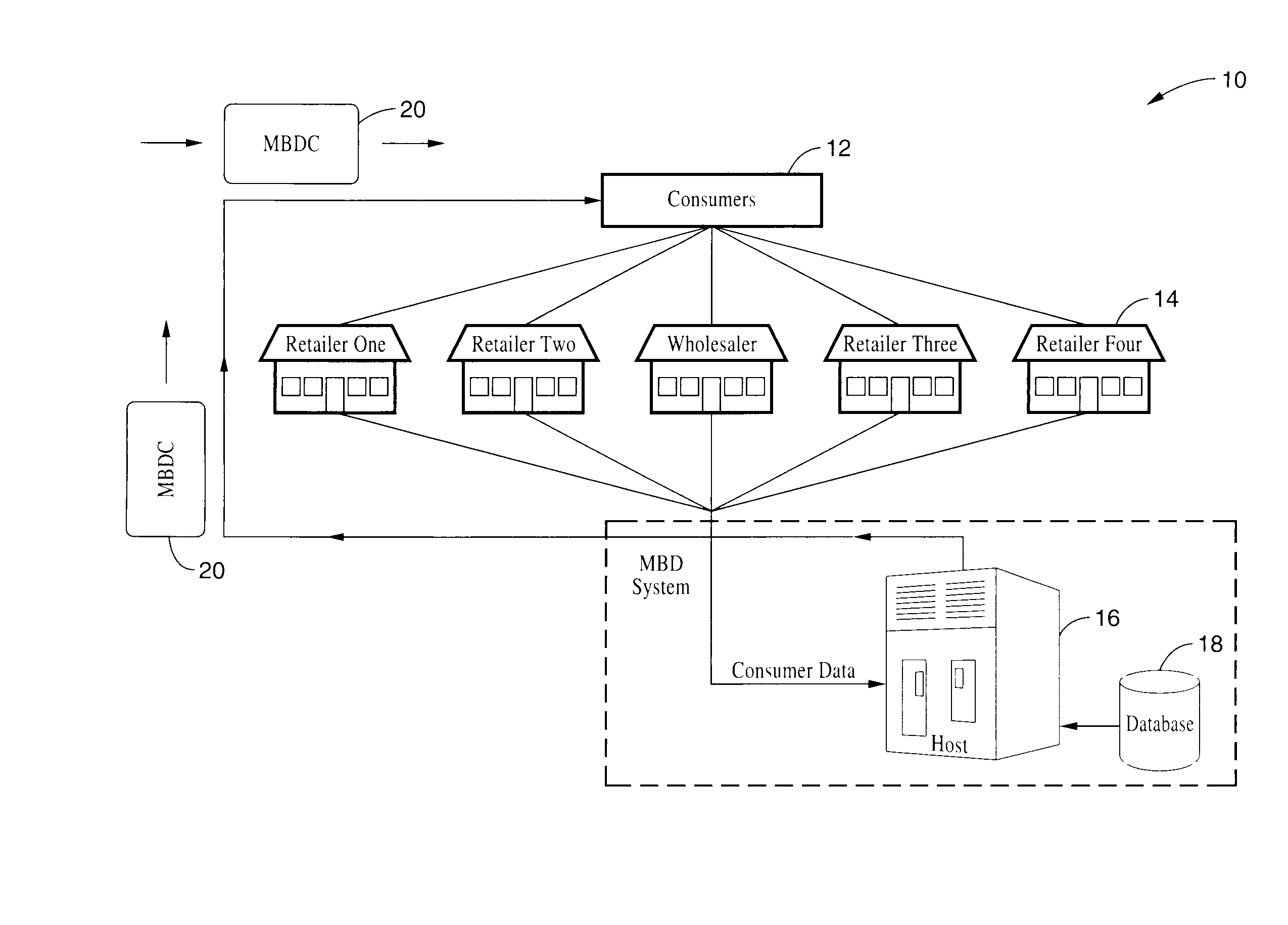

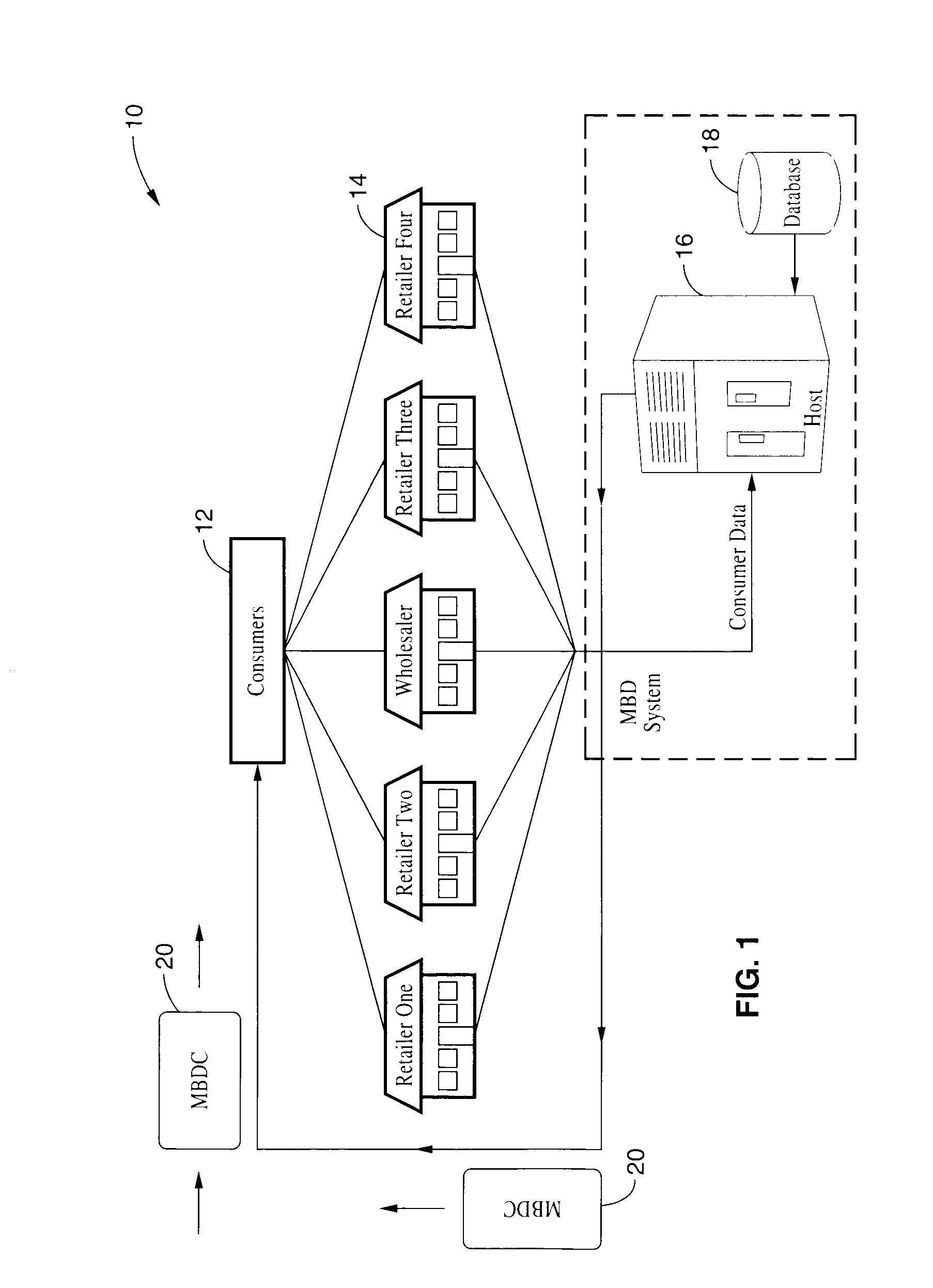

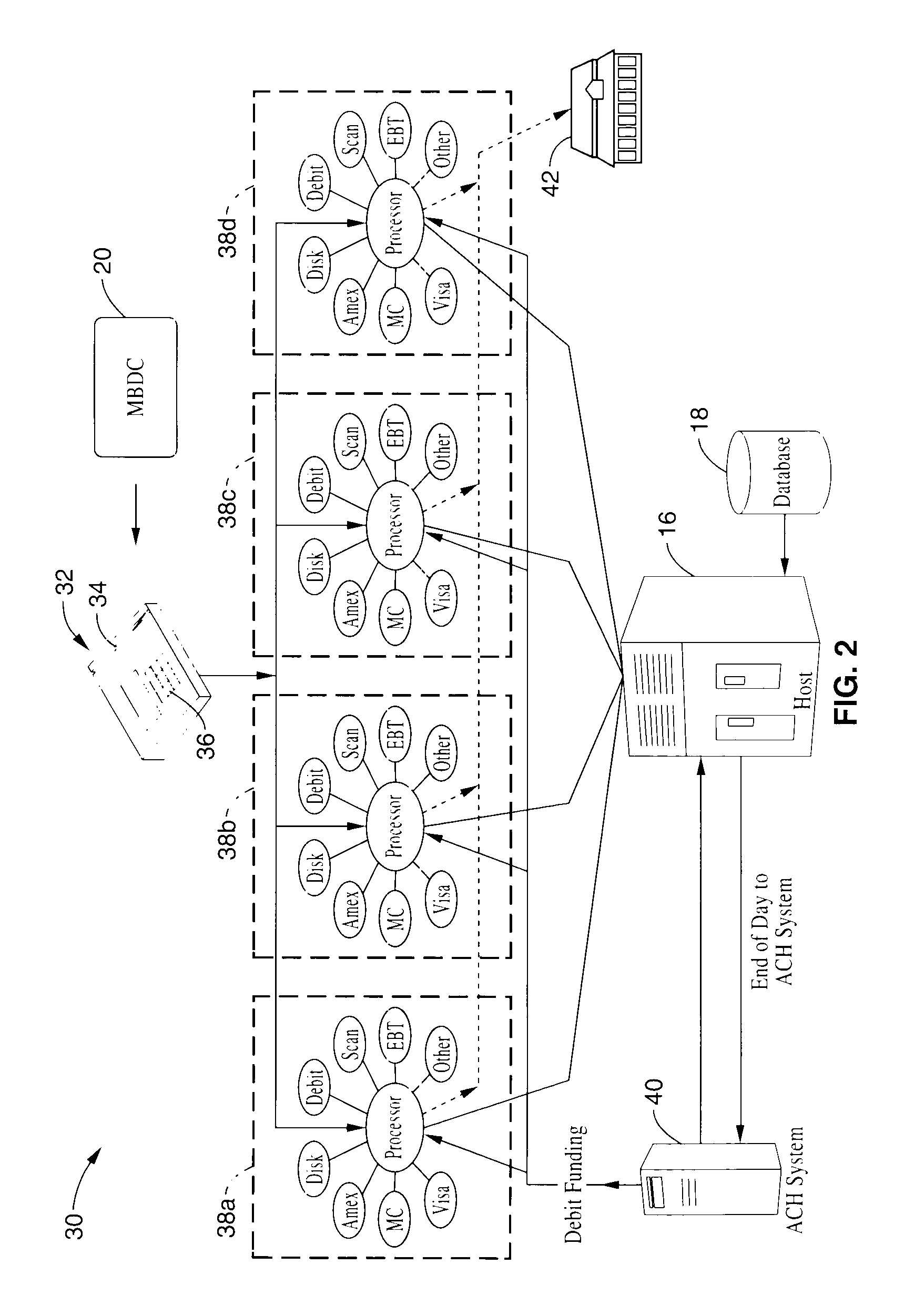

A method and system for executing electronic funds transactions using a merchant based debit (MBD) card in a merchant-centric system that provides for reduced fees to acquiring merchants and remitting a portion of the collected fees to issuing merchants. The system also preferably provides information sharing on consumer transactions with merchants to facilitate consumer based incentive programs and the like. The system operates over conventional card processing infrastructure and utilizes the ACH network, or equivalent, to settle the transaction from a consumer checking account, or a merchant account in the case of a prepaid MBD card. Using the system, merchants may elect to qualify customers based on their own criterion. A portion of the interchange fee is distributed to the issuing merchant associated transaction executed using the merchant based debit card. Embodiments are described for prepaid, fixed value, programmable, and refillable, forms of merchant based debit cards.

Owner:KIOBA PROCESSING LLC

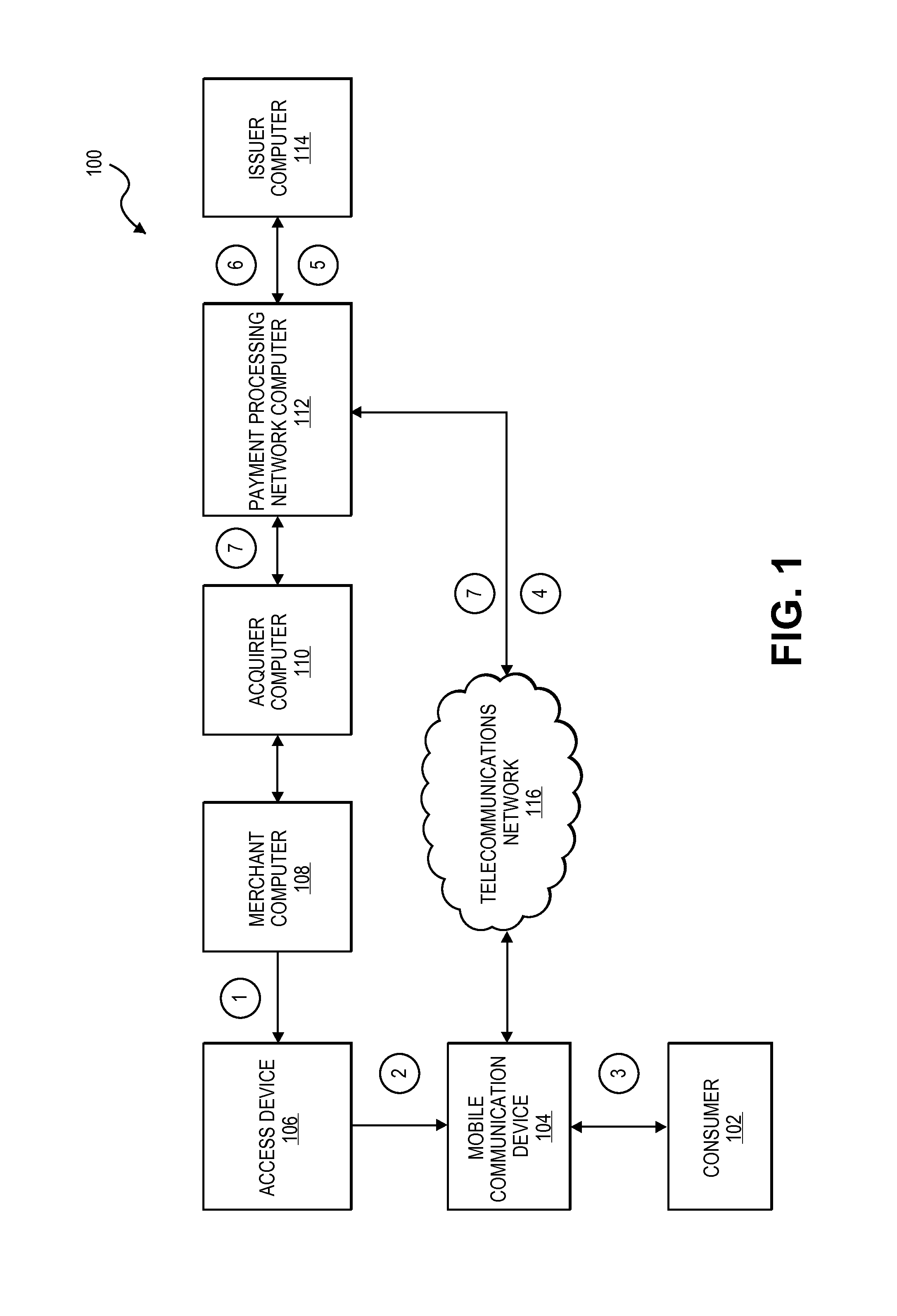

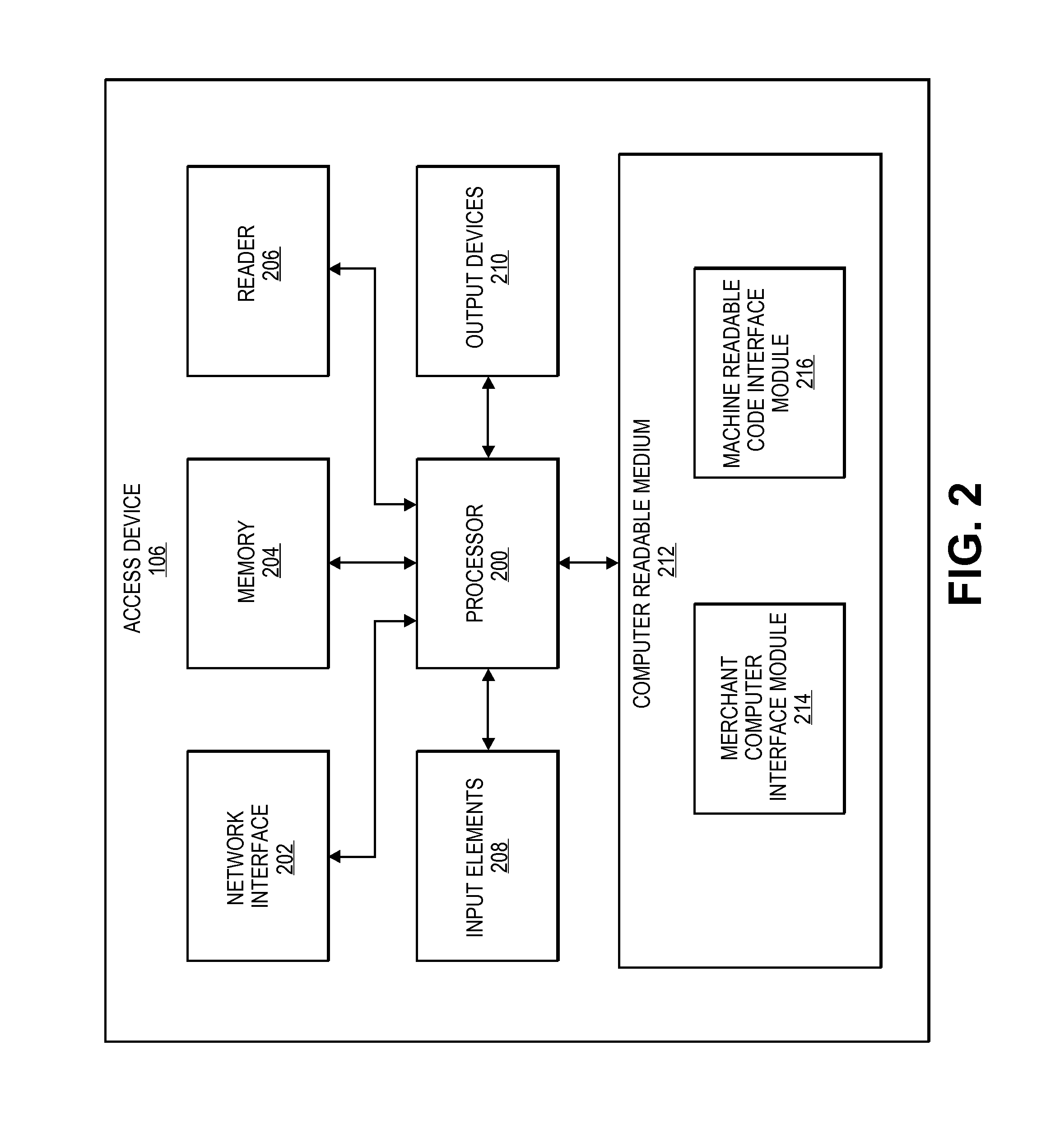

System and method using merchant token

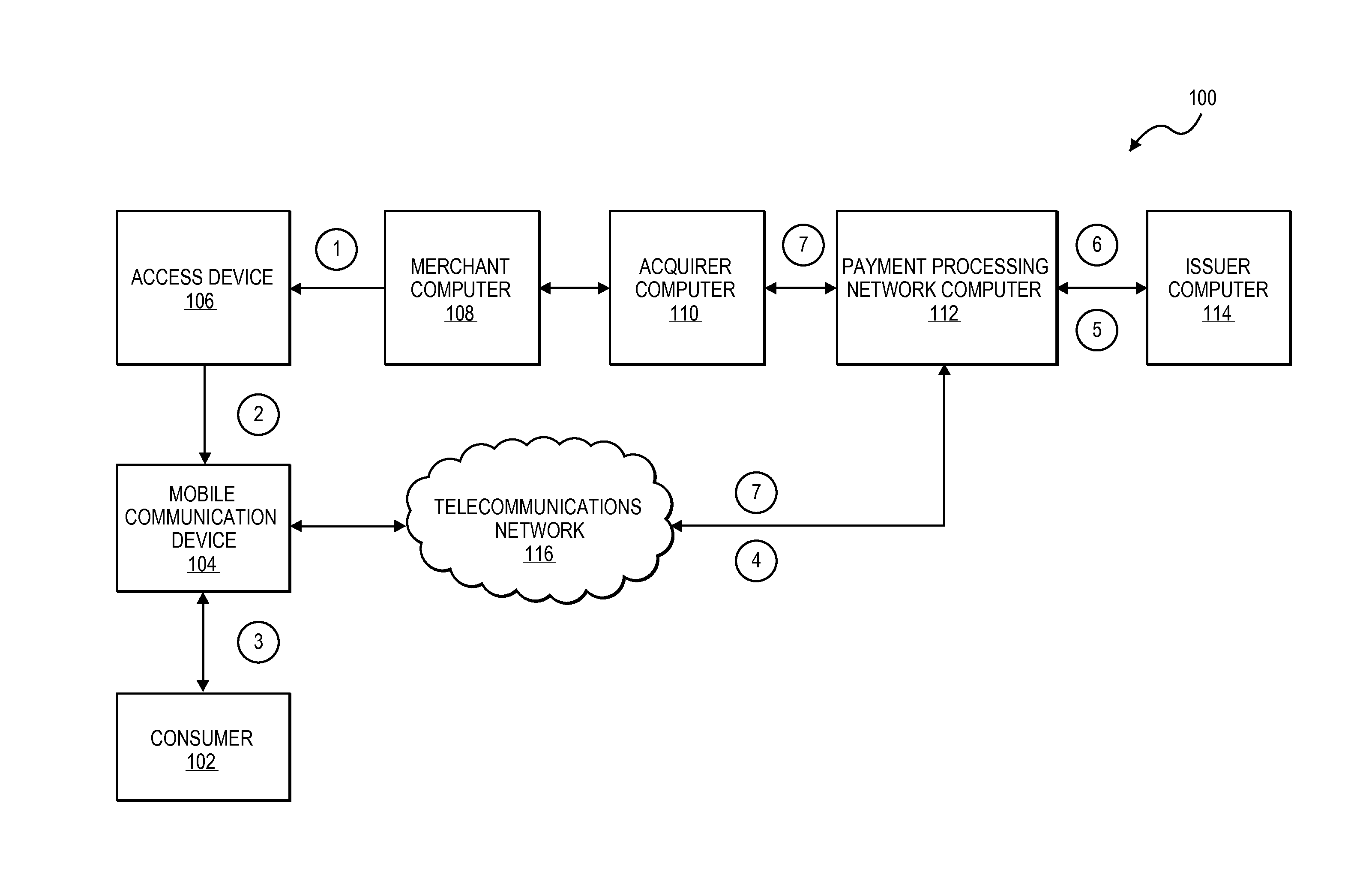

A merchant computer generates a token including a “pay-me” merchant account identifier and transaction data for a transaction conducted by a consumer. The merchant token can be obtained by a mobile communication device and transmitted to a payment processing network along with a device identifier for the mobile communication device and an authentication token provided by the consumer. The payment processing network can authenticate the device using the authentication token, retrieve a consumer account number based on the device identifier, and complete the transaction by pushing money into the merchant “pay-me” account from the consumer account.

Owner:VISA INT SERVICE ASSOC

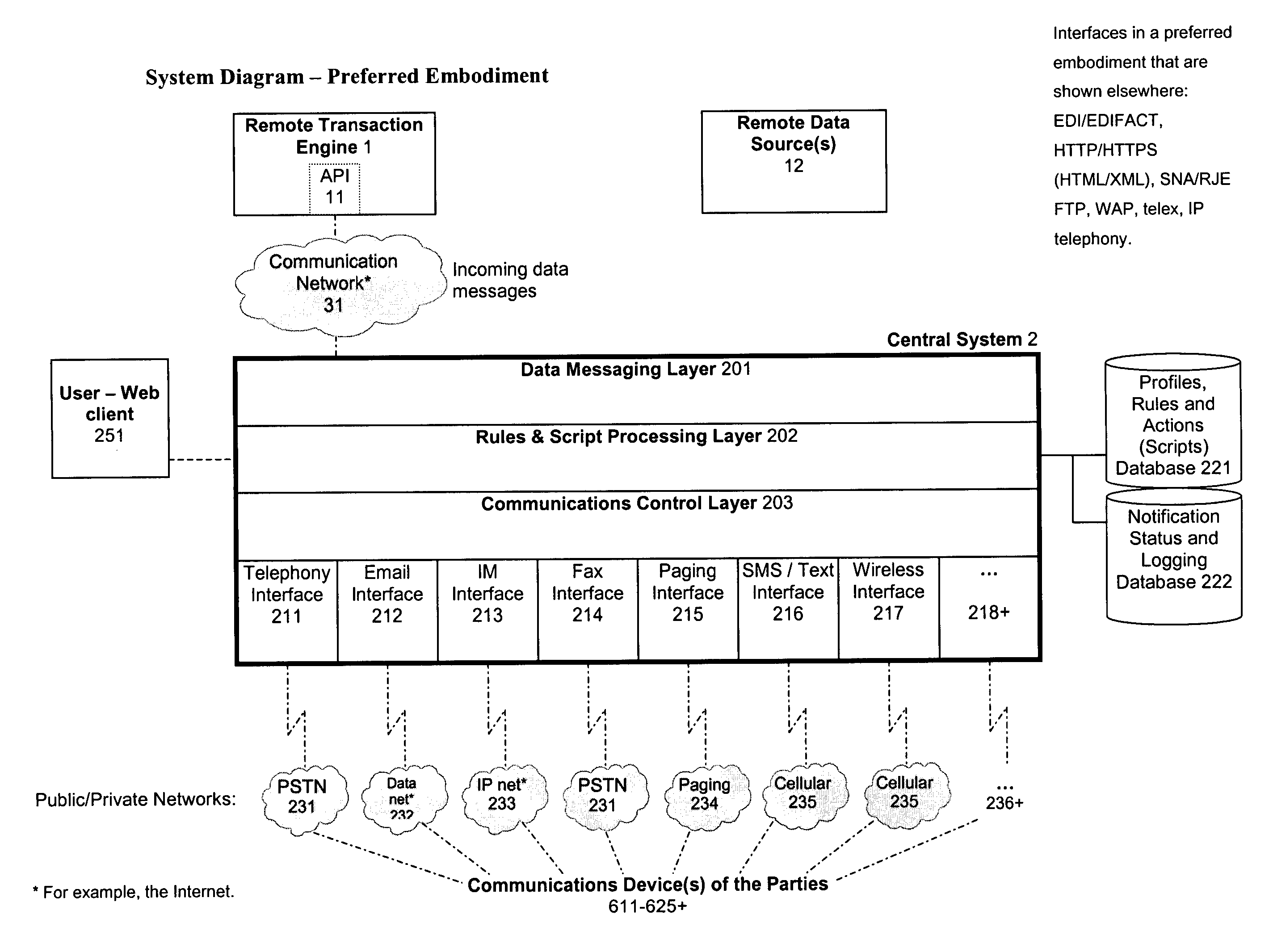

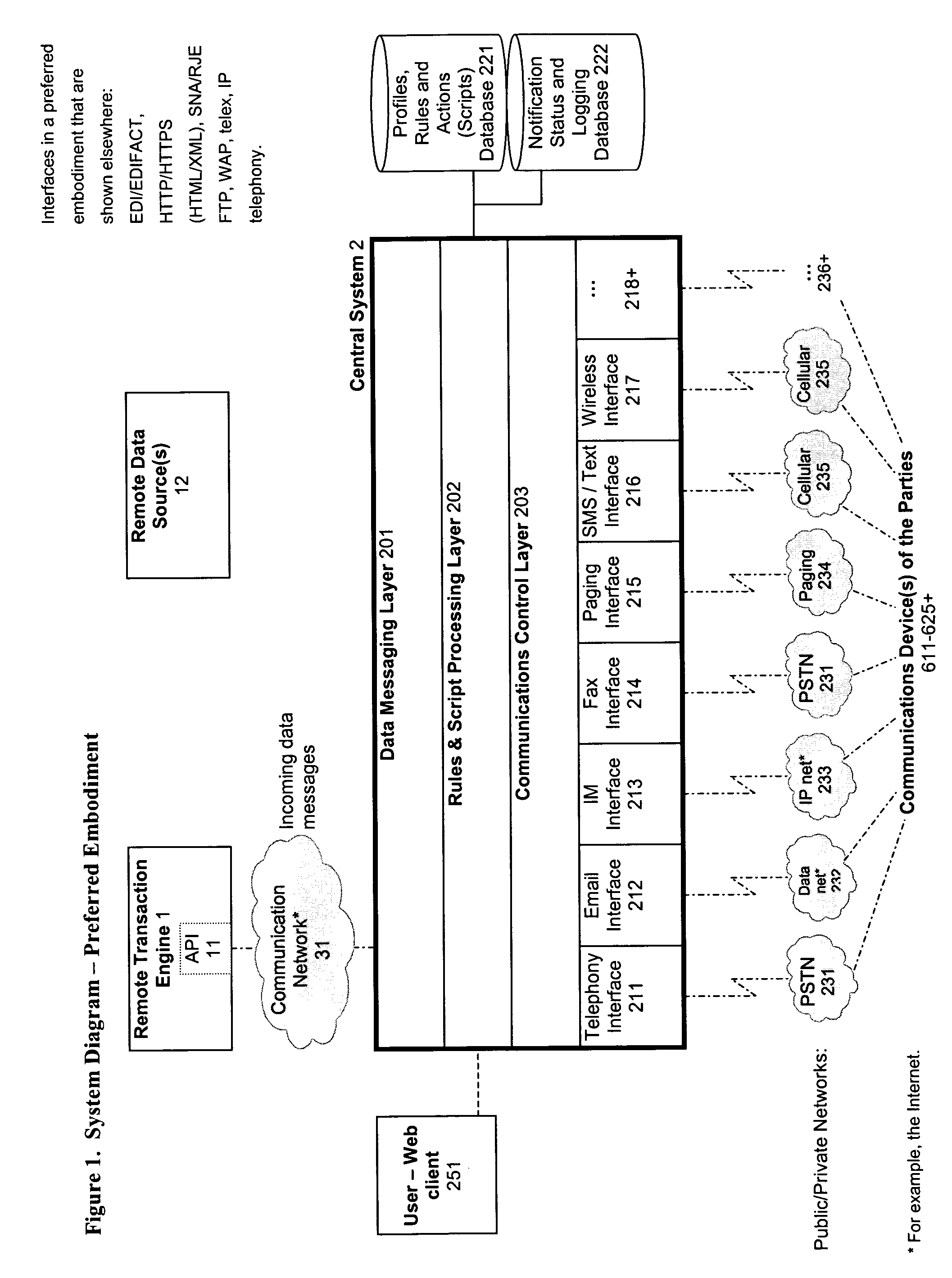

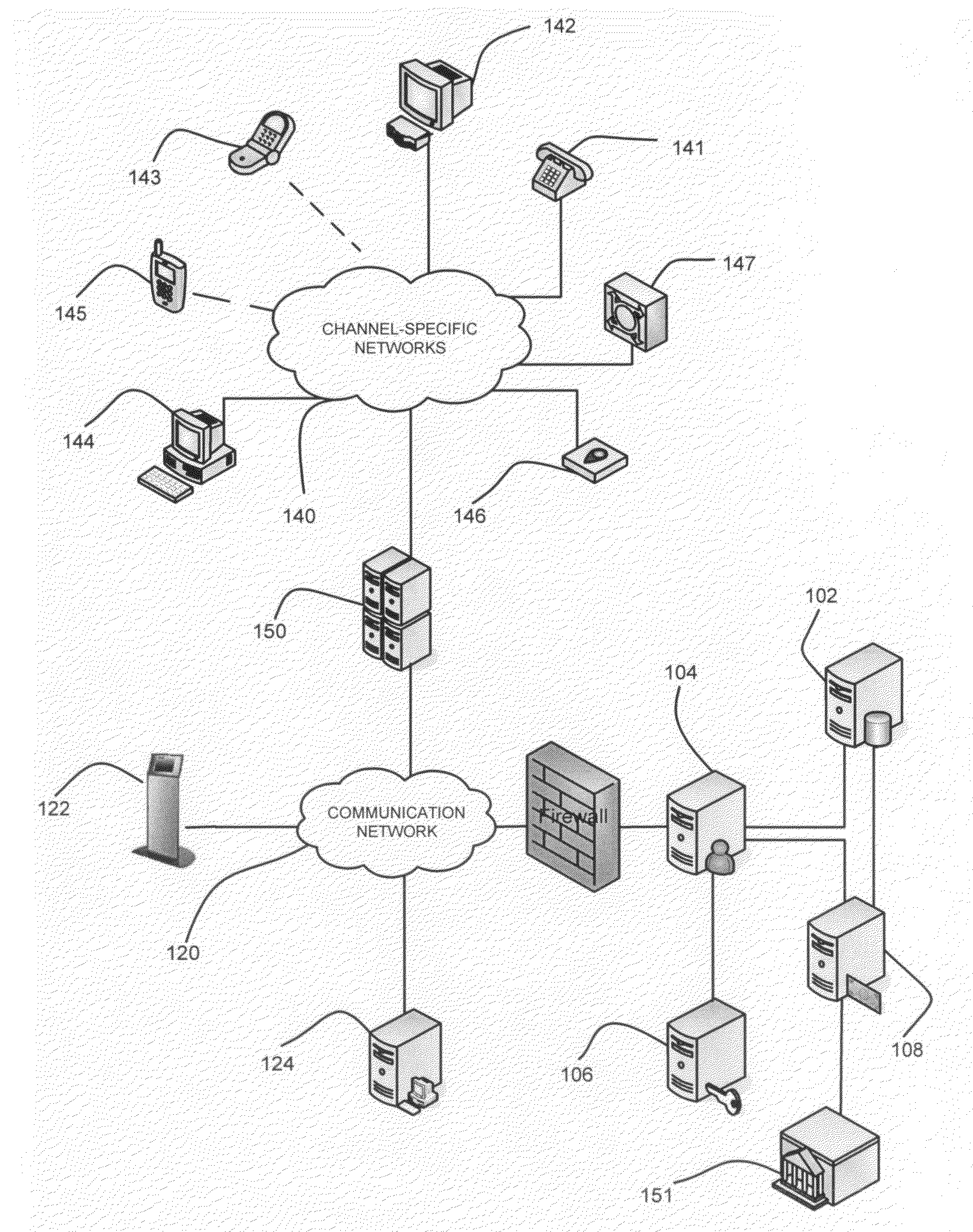

System and method for verification, authentication, and notification of a transaction

ActiveUS20040078340A1Increase valueFinanceBuying/selling/leasing transactionsTelecommunications linkSocial Security number

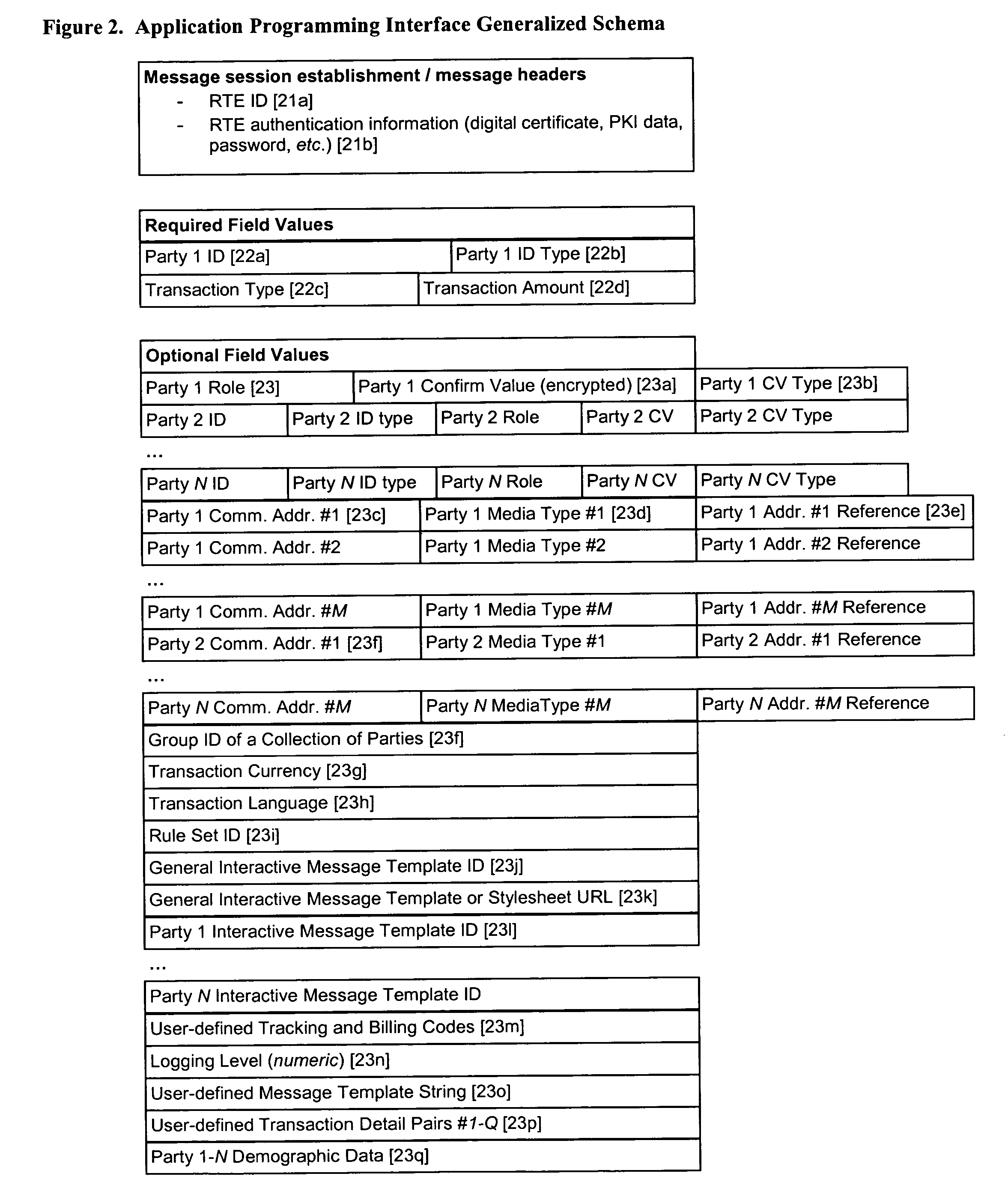

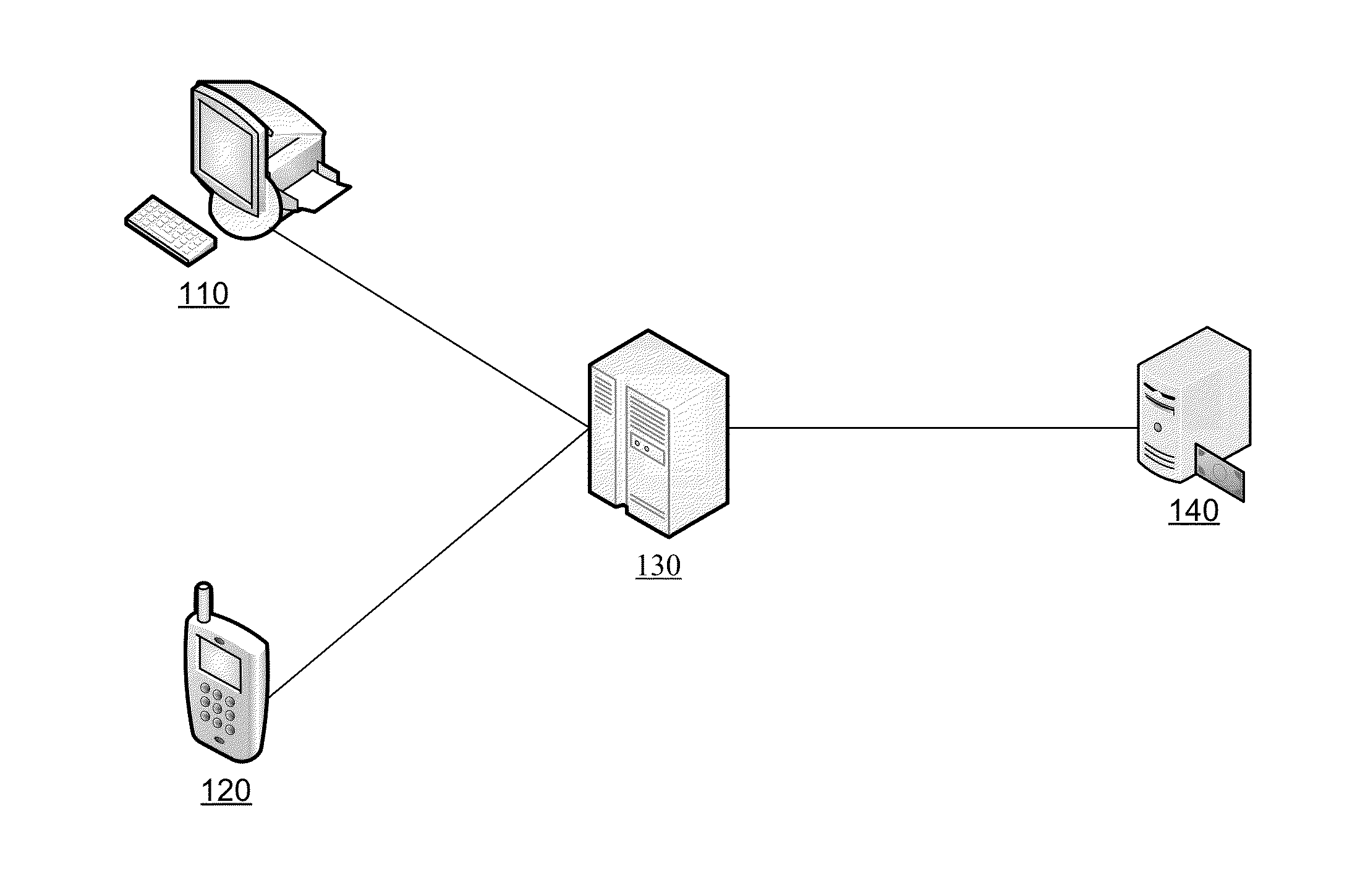

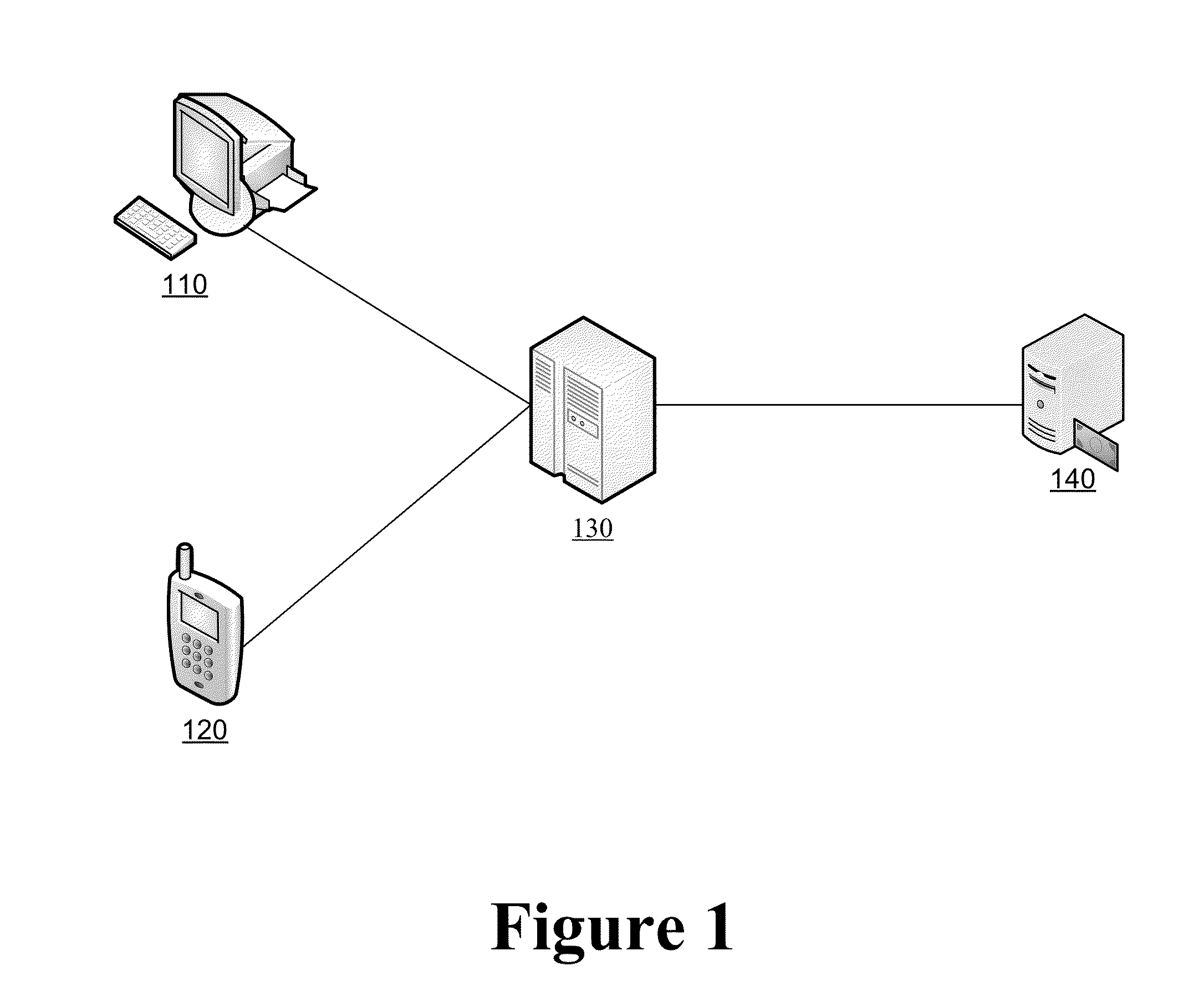

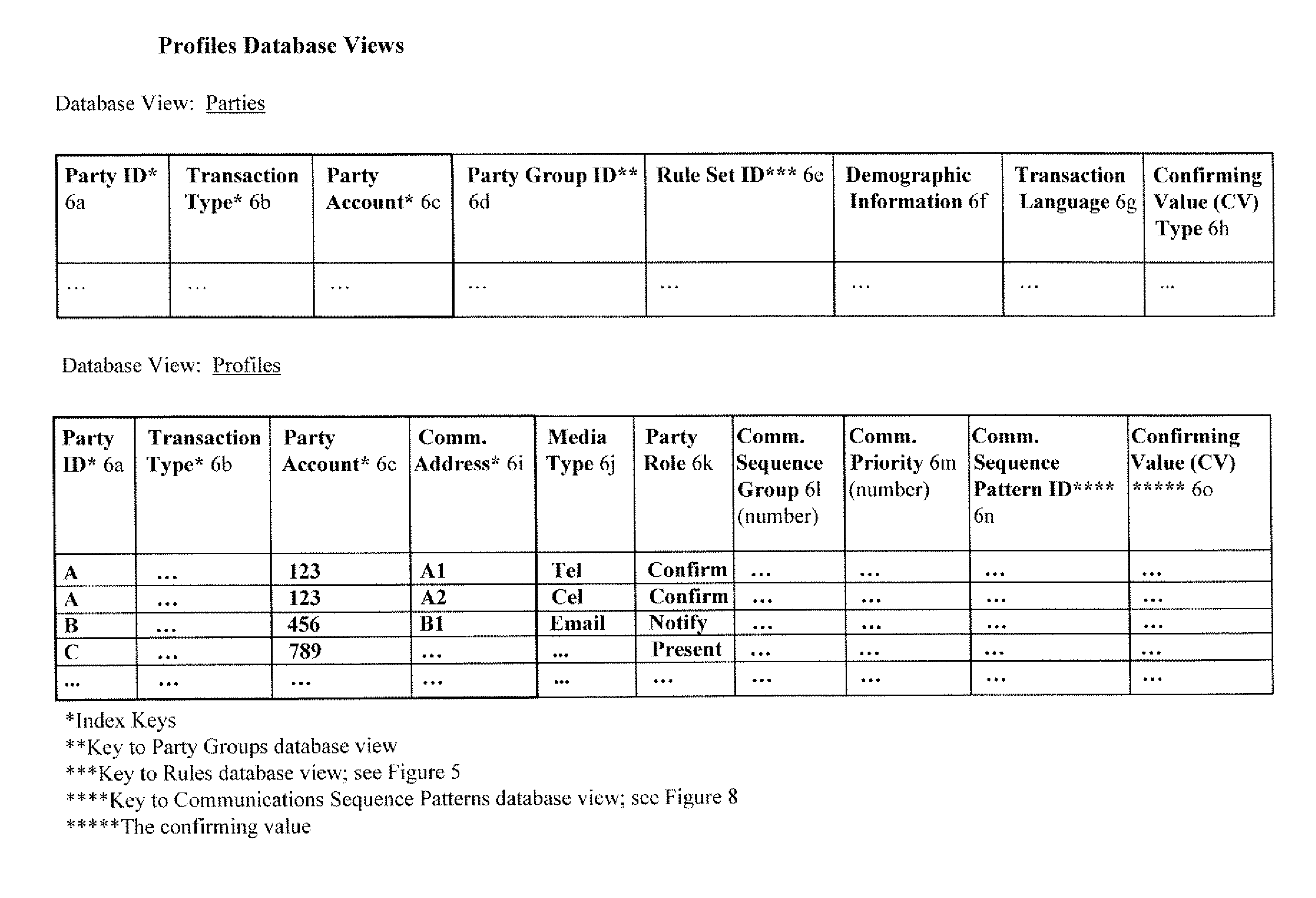

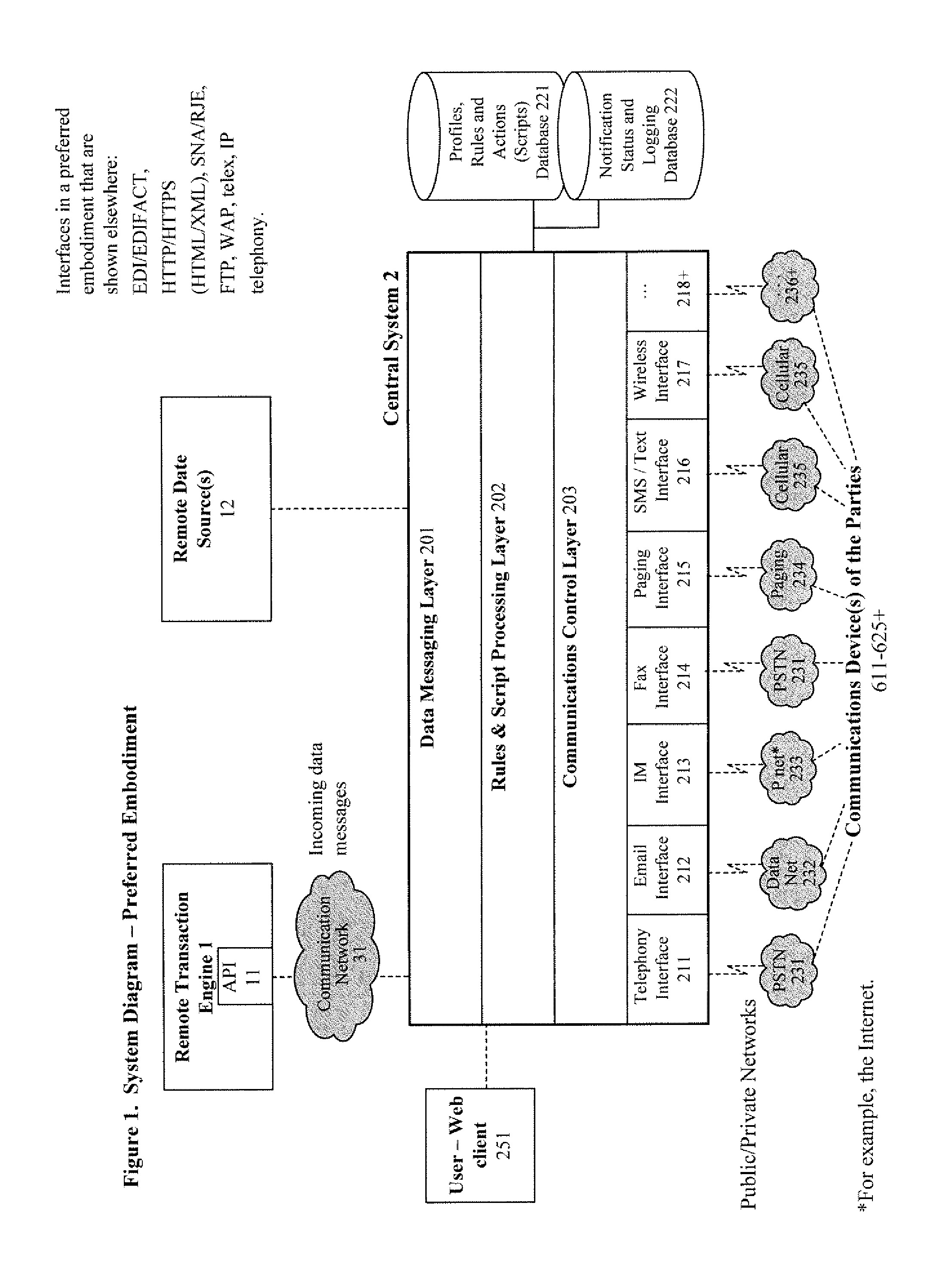

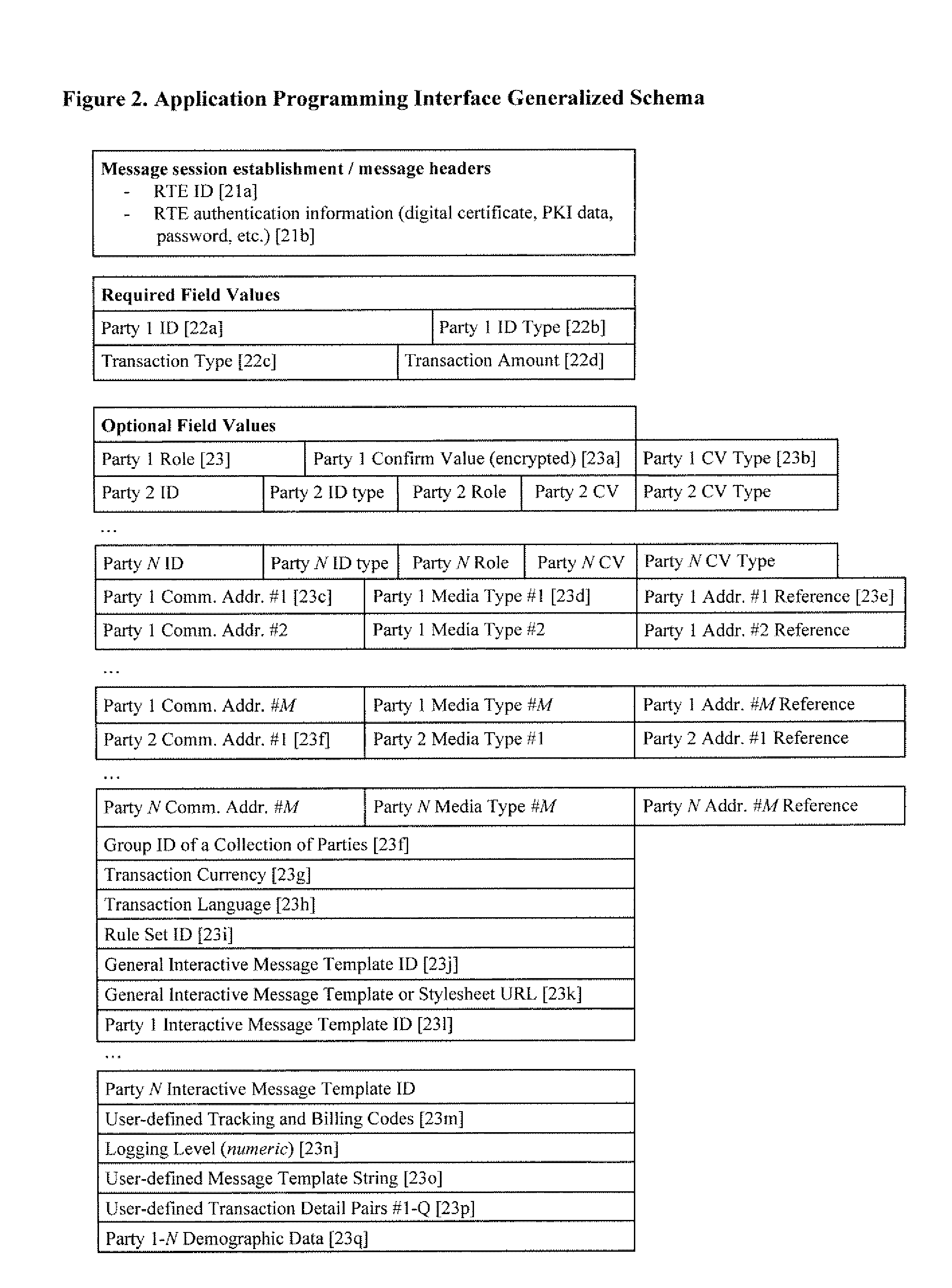

A system and method for verifying, authenticating, and providing notification of a transaction, such as a commercial or financial transaction, with and / or to at least one party identified as engaging in the transaction and / or identified as having a potential interest in the transaction or type of transaction, are provided. A central system accepts information regarding a transaction, including information about at least one party identified as engaging in the transaction, such as by a credit account number or Social Security number or merchant account number, and / or identified as having a potential interest in the transaction. Based on the information regarding the transaction and any supplemental information the central system determines, the central system communicates with and / or to at least one party and / or additional or alternative parties, via at least one communications device or system having a communications address, such as a telephone number or Short Message Service address, predetermined as belonging to the at least one party and / or additional or alternative parties. Via said communications, at least one party having an interest or a potential interest in the transaction may be notified of it, and may further be enabled or required to supply additional verifying or authenticating information to the central system. If the transaction was initiated or engaged in via a communications link, such as via the Internet, said communications preferably occur over at least one different communications link and / or protocol, such as via a wireless voice network. The central system may then compute a result based on the outcomes of said communications, and may then transmit the result to the user and / or to a second system or device.

Owner:ST ISIDORE RES

System and method for point of service payment acceptance via wireless communication

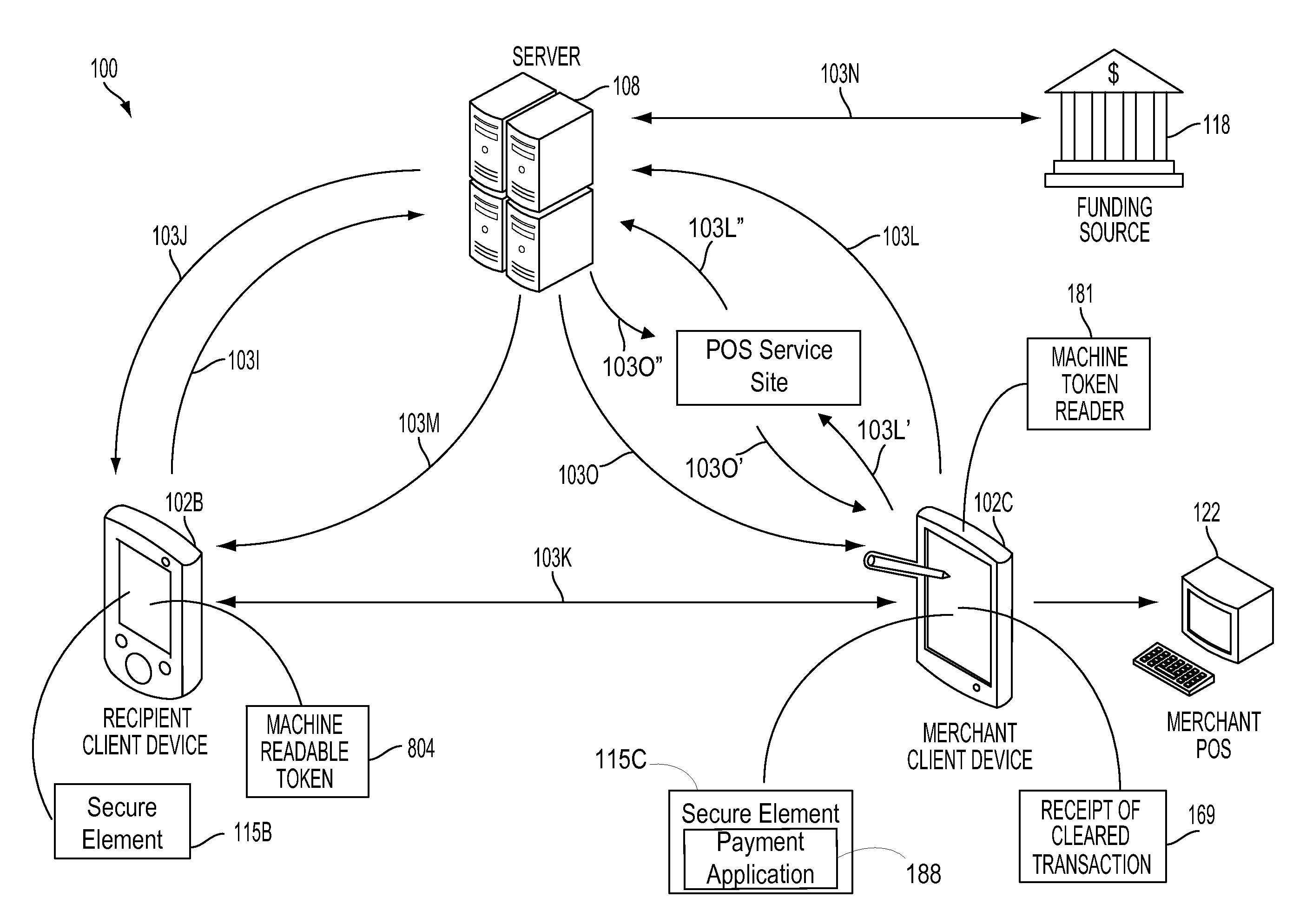

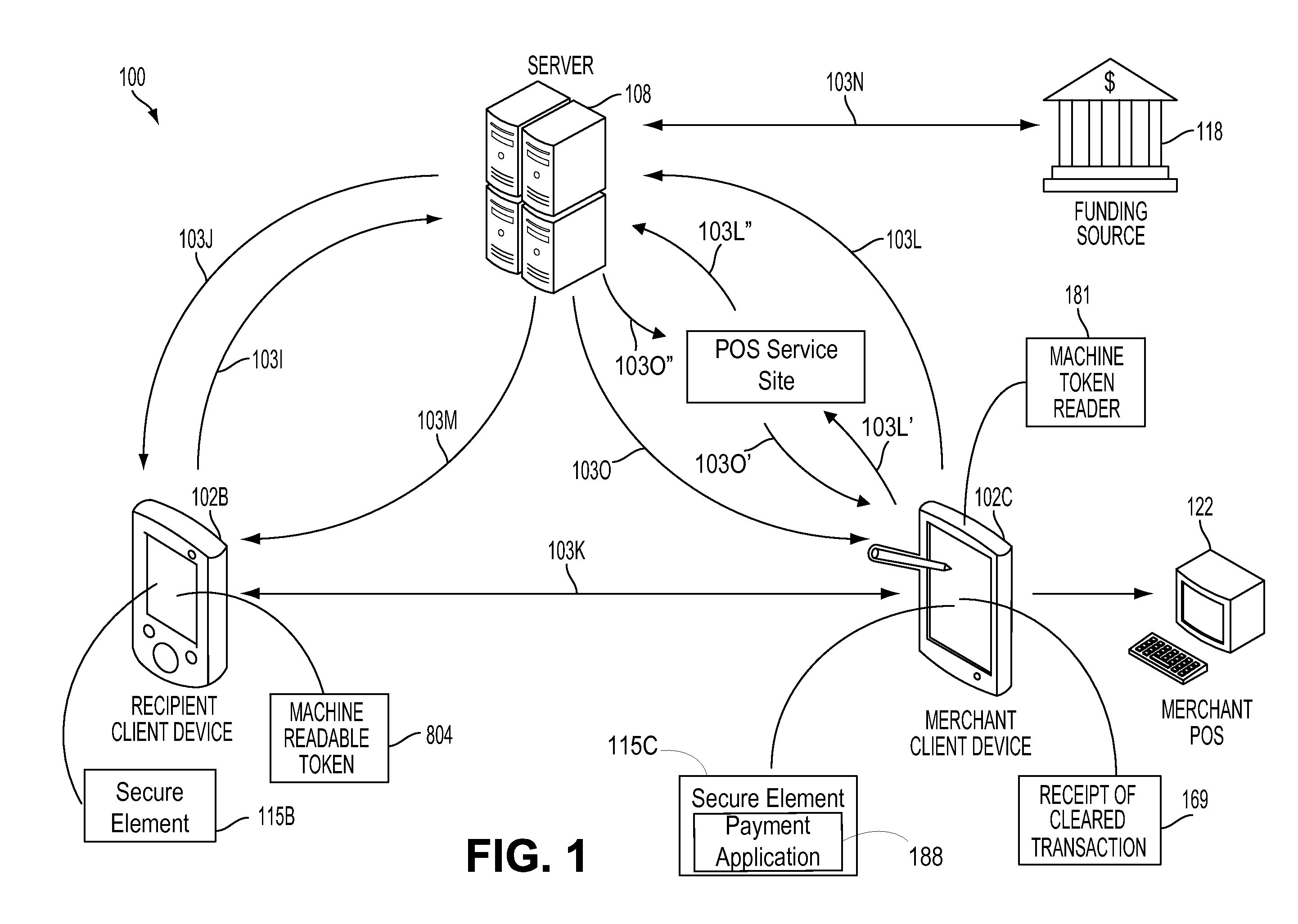

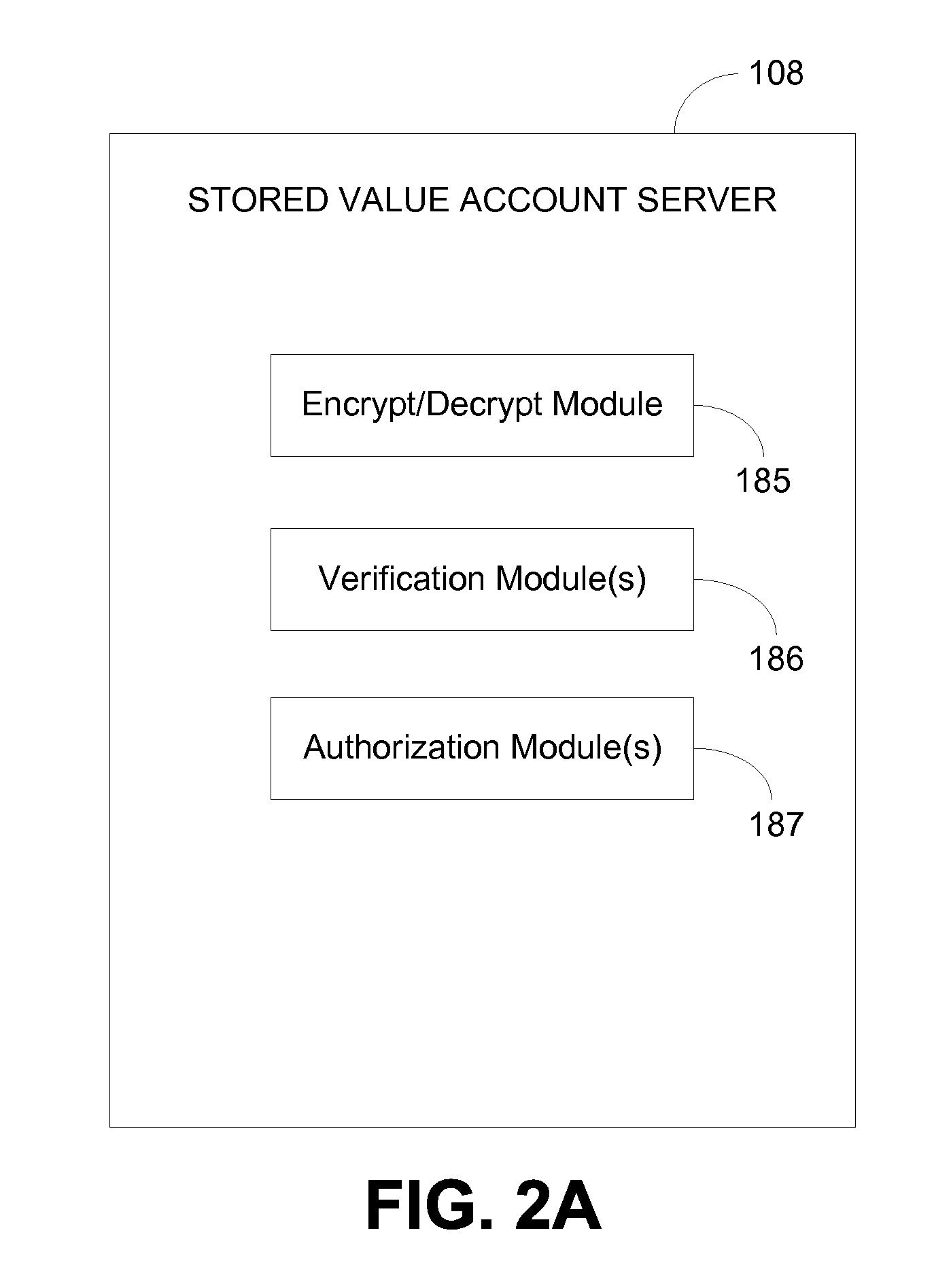

A system and method for remitting payment from a consumer's credit or stored value account by digital presentations of account information are described. A merchant may create one or more merchant account at a point-of-sale service site (“POS service site”) and associate one or more merchant portable computing devices (“MPCDs”) with one or more of the merchant accounts. Each MPCD may be configured to receive customer data from a customer via one of a visual capture and a wireless communication, such as a near field communication (“NFC”) or a machine-readable optical code. The customer data may be received from an NFC-capable physical token such as an EMV card, or a virtual token presented by a customer portable computing device (“CPCD”) using a NFC or a machine-readable optical code. Each MPCD may contain a point-of-sale payment application supplied by the POS service site that may capture data representative of a consumer account from the received customer data.

Owner:QUALCOMM INC

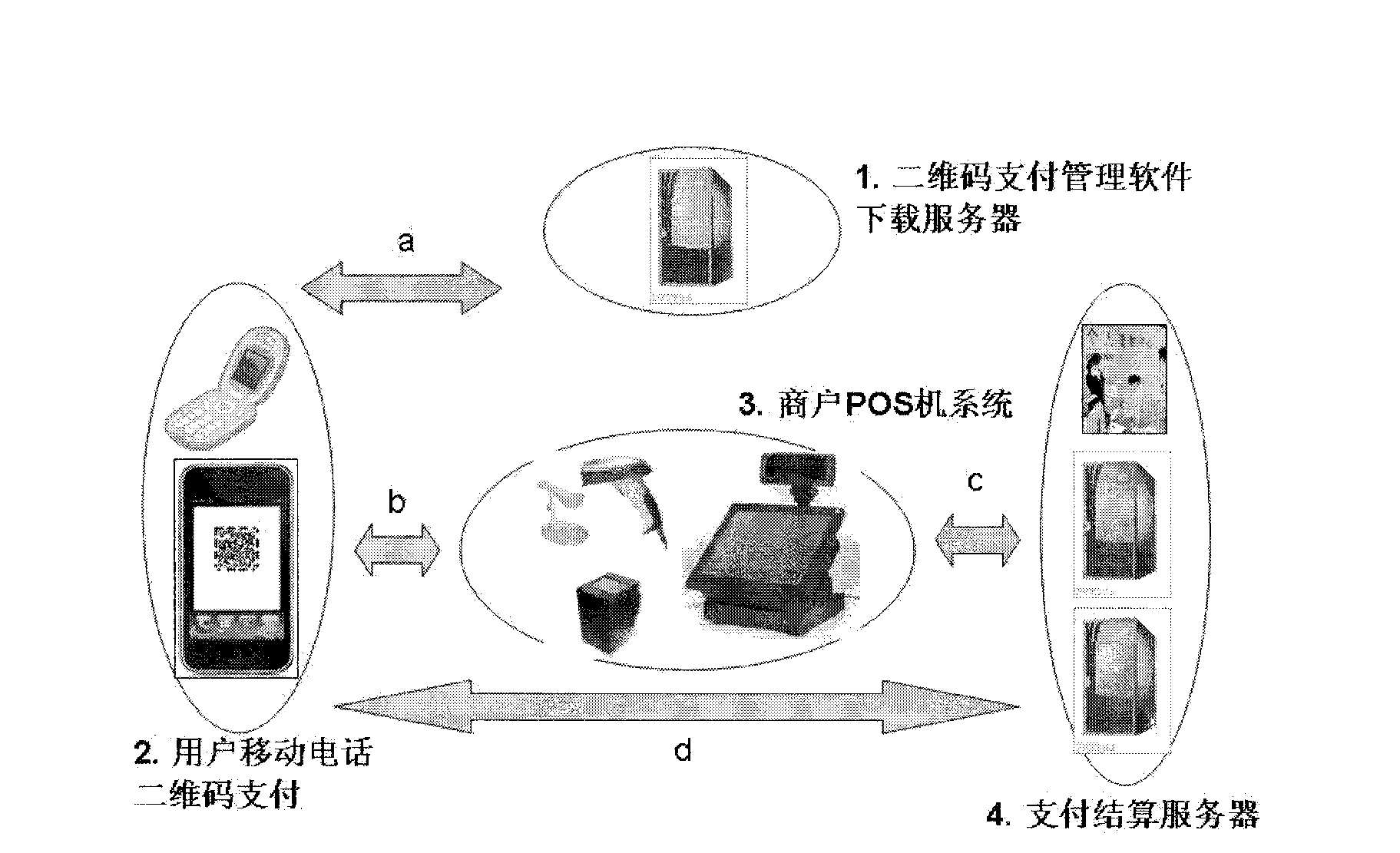

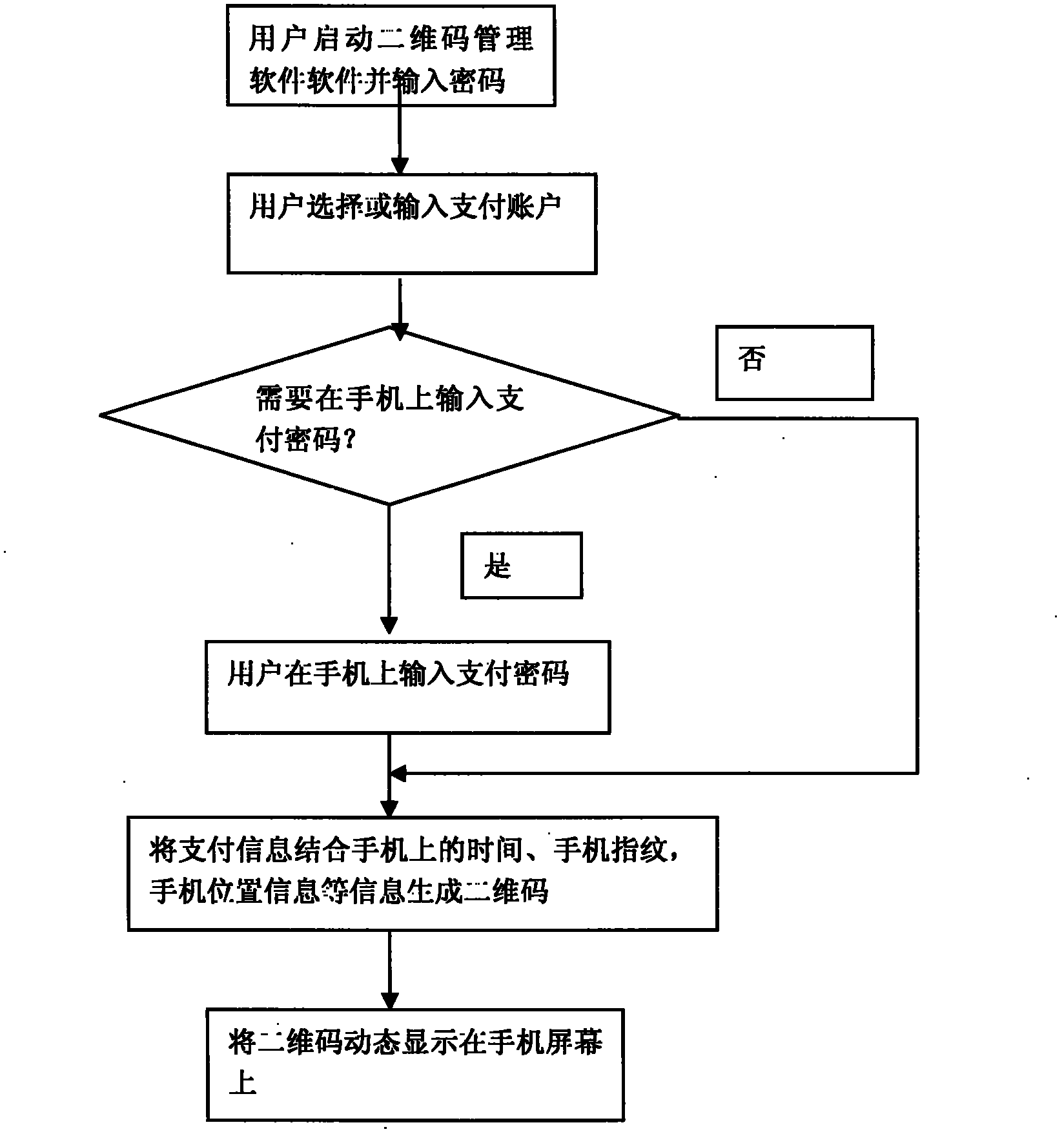

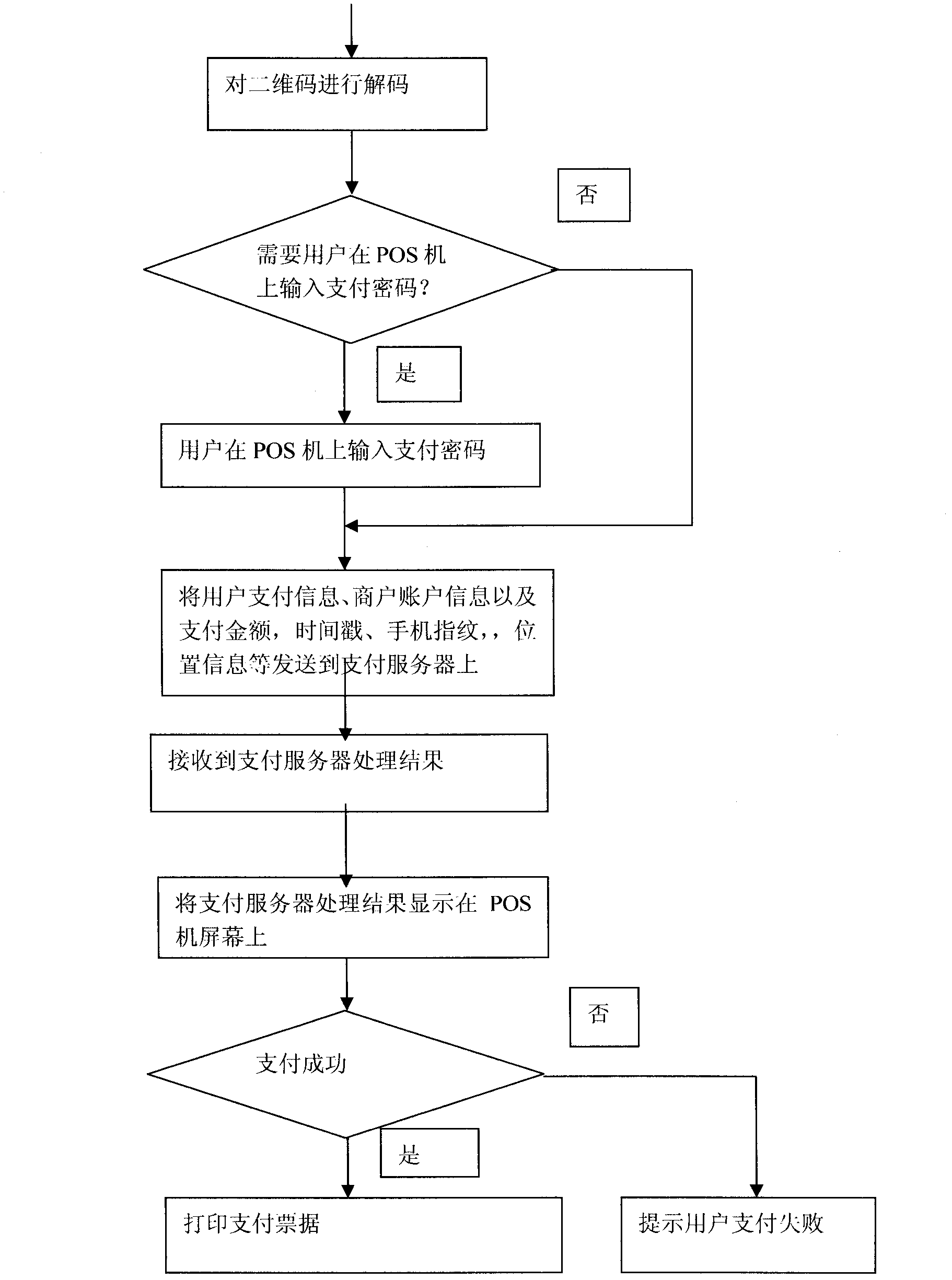

Method for generating two-dimensional code and implementing mobile payment by mobile phone

InactiveCN102842081AEnsure uniquenessEnsure safetyPayment protocolsCoded identity card or credit card actuationComputer hardwareCredit card

The invention relates to a method for generating a two-dimensional code and implementing mobile payment by a mobile phone. A user can input various payment card information (such as bank card account numbers, credit card account numbers, prepaid card account numbers, and third party payment user account numbers) into the mobile phone, the information is enciphered and stored, and then the two-dimensional code is generated and displayed on a screen of the mobile phone. A merchant scans a pattern of the two-dimensional code through a two-dimensional code identifying and reading device, and after user authentication information (such as two-dimensional code generation time, mobile phone fingerprints and mobile phone positions) and the payment card information are decoded, the user authentication information, the payment card information, consumption amount information of the user, merchant account number information and the like are enciphered and sent to a corresponding payment and settlement system. After receiving the information, a payment and settlement server confirms the payment card information to be true or false according to the two-dimensional code authentication information, and carries out payment transaction. The method has the main advantage that the user can save the information of various payment cards, consumption cards and the like in the mobile phone and realize no-card electronic payment transaction instead of the various payment cards.

Owner:上海易悠通信息科技有限公司

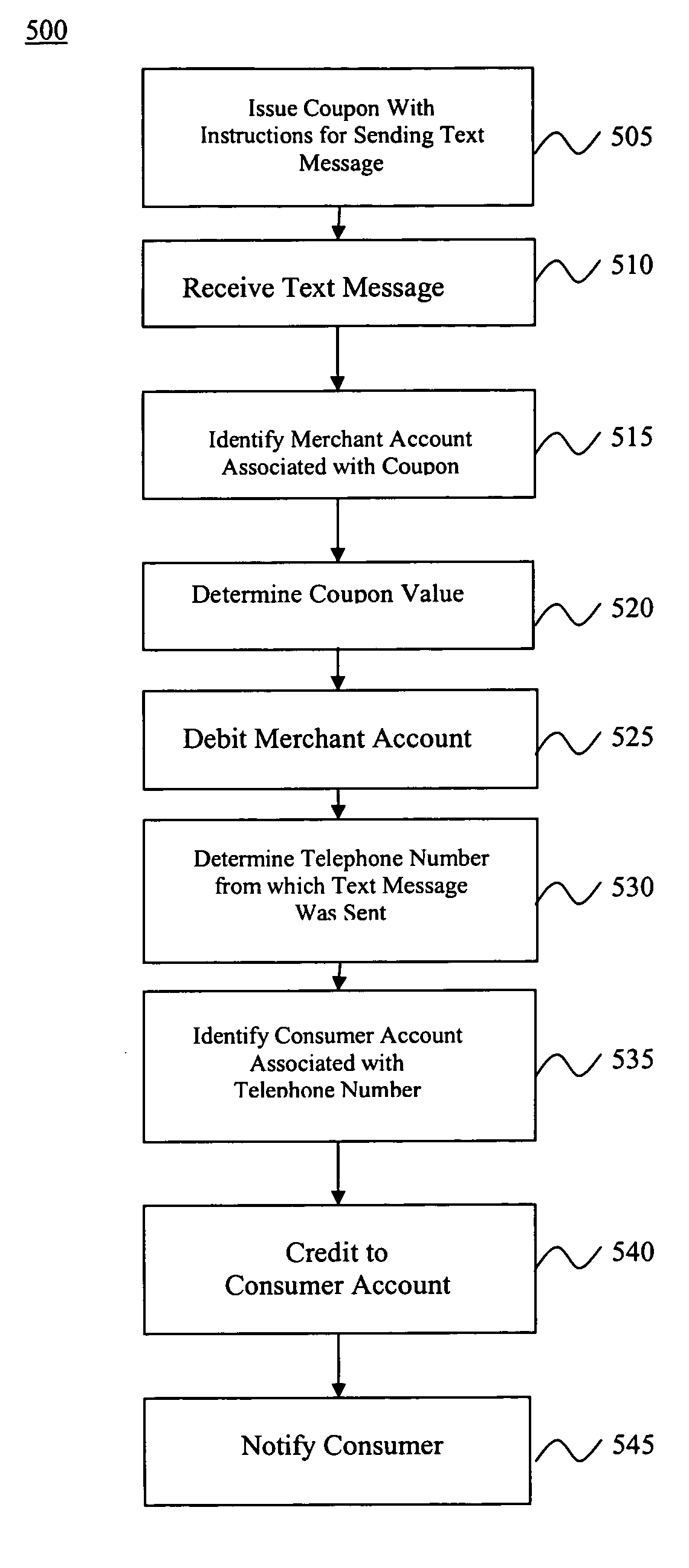

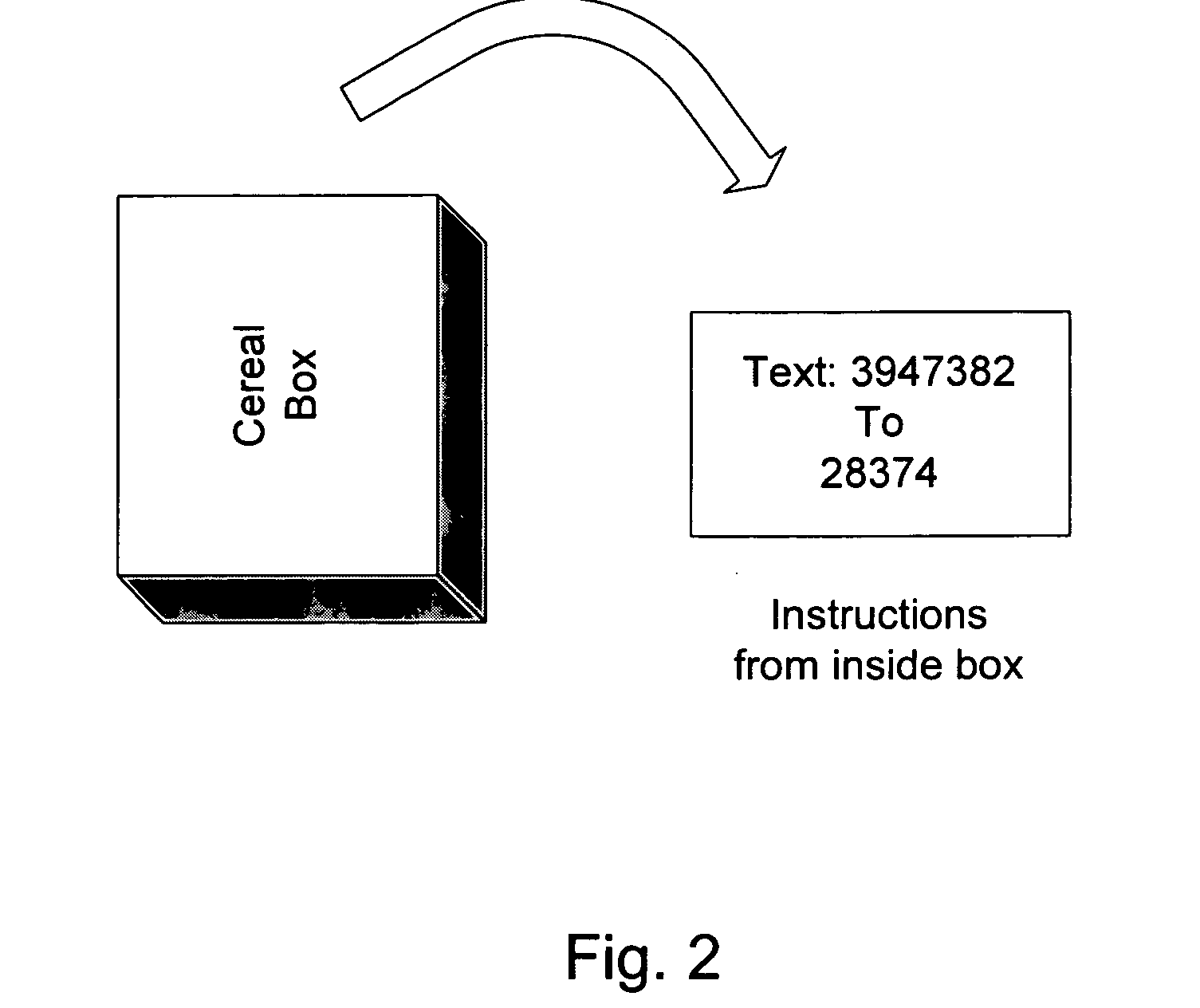

System and method for redemption of a coupon using a mobile cellular telephone

A system and a method for redeeming a coupon issued by a merchant are provided. The method includes the steps of receiving a text message transmitted by a user, determining a telephone number from which the text message was transmitted, debiting an amount corresponding to the value of the coupon from a merchant account, and depositing the amount into a user account. The coupon redemption message includes merchant identification and a value of the coupon. The user is sent a notification message, typically via the user's mobile cellular telephone, to inform the user that the amount corresponding to the coupon value has been deposited into the user account. Each of the accounts may be associated with an internet-based payment system. The value of the coupon may be expressible as either currency, mileage credit, points associated with a merchant loyalty program, or prepaid minutes of mobile cellular telephone usage.

Owner:SHOPTEXT INC

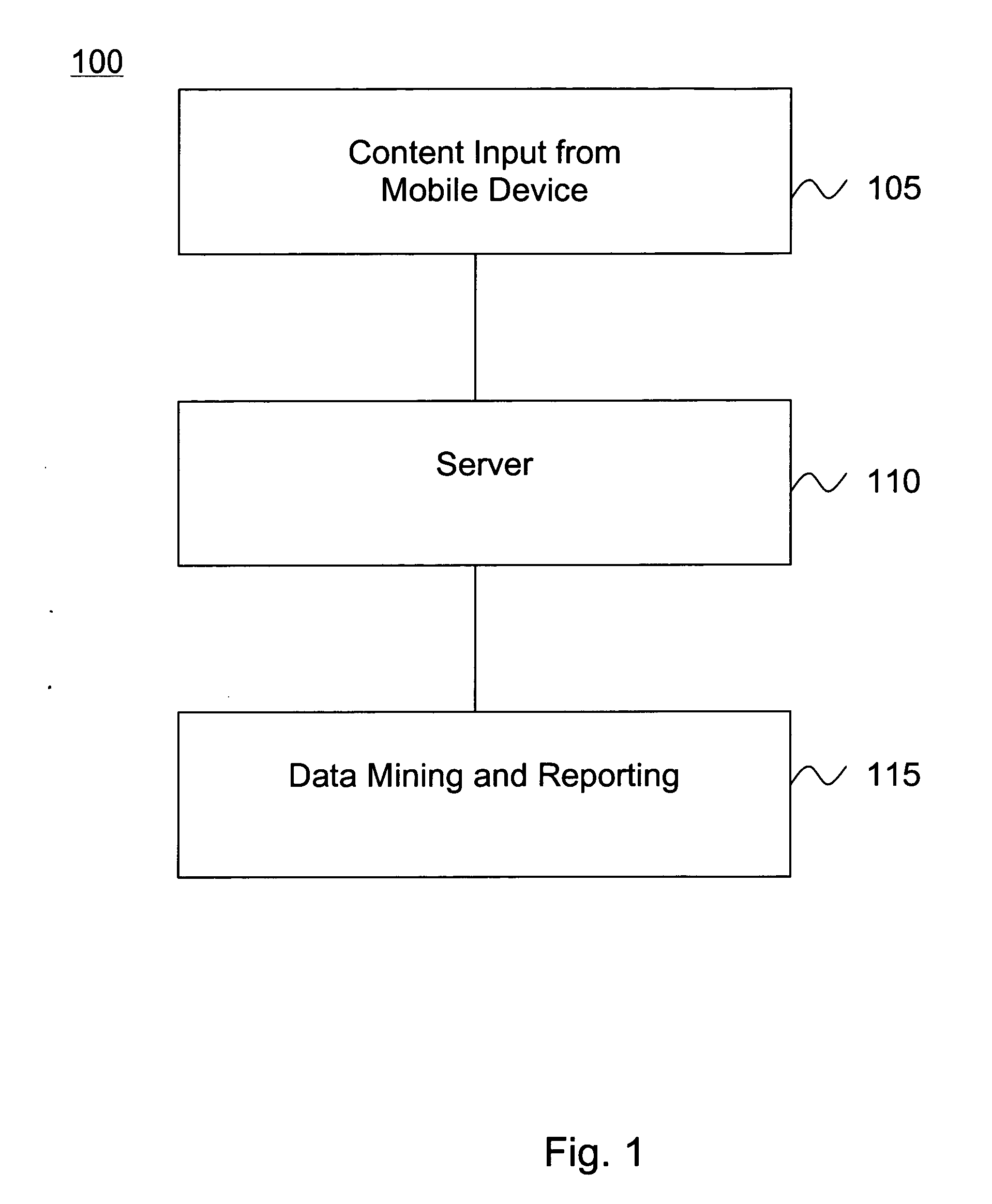

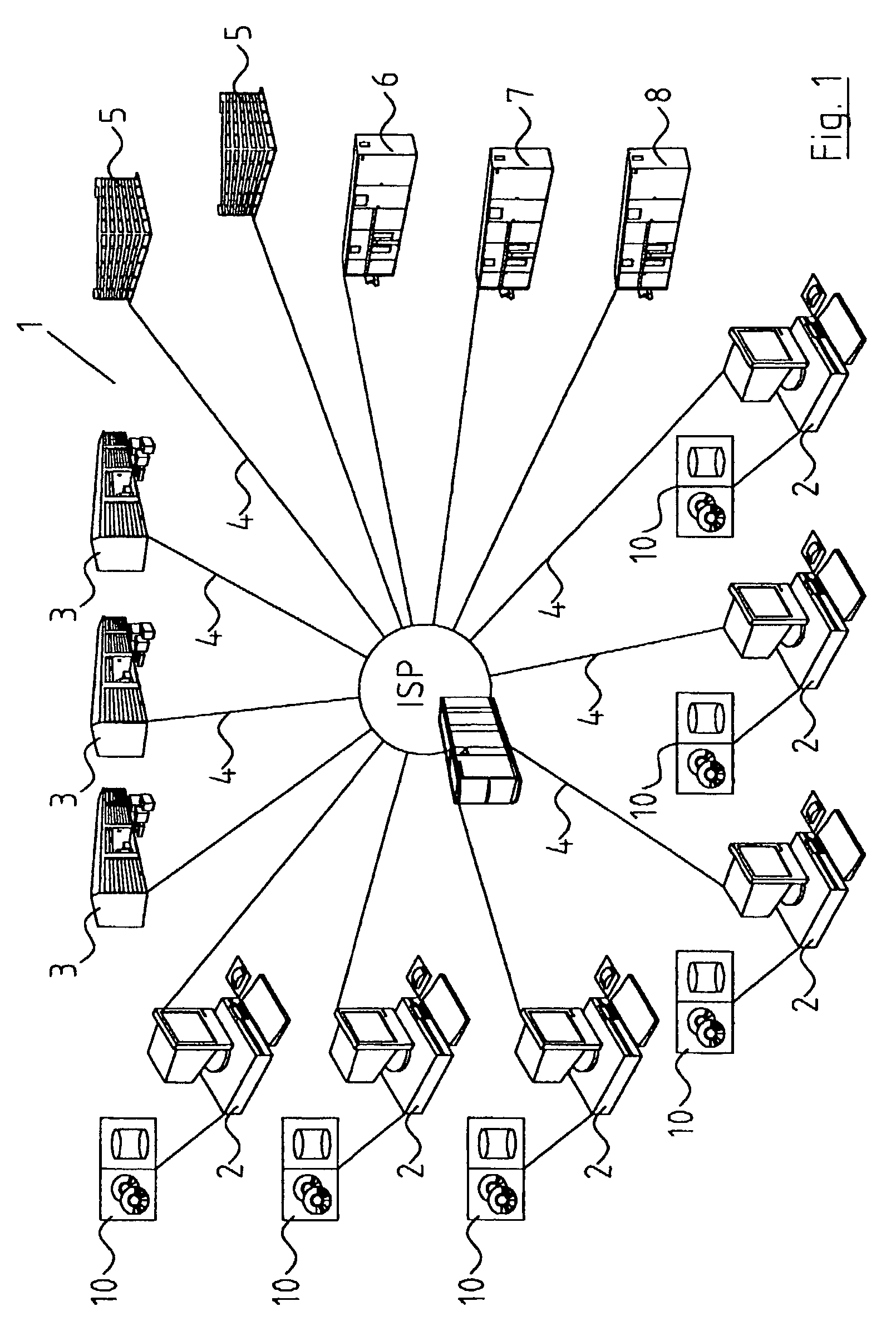

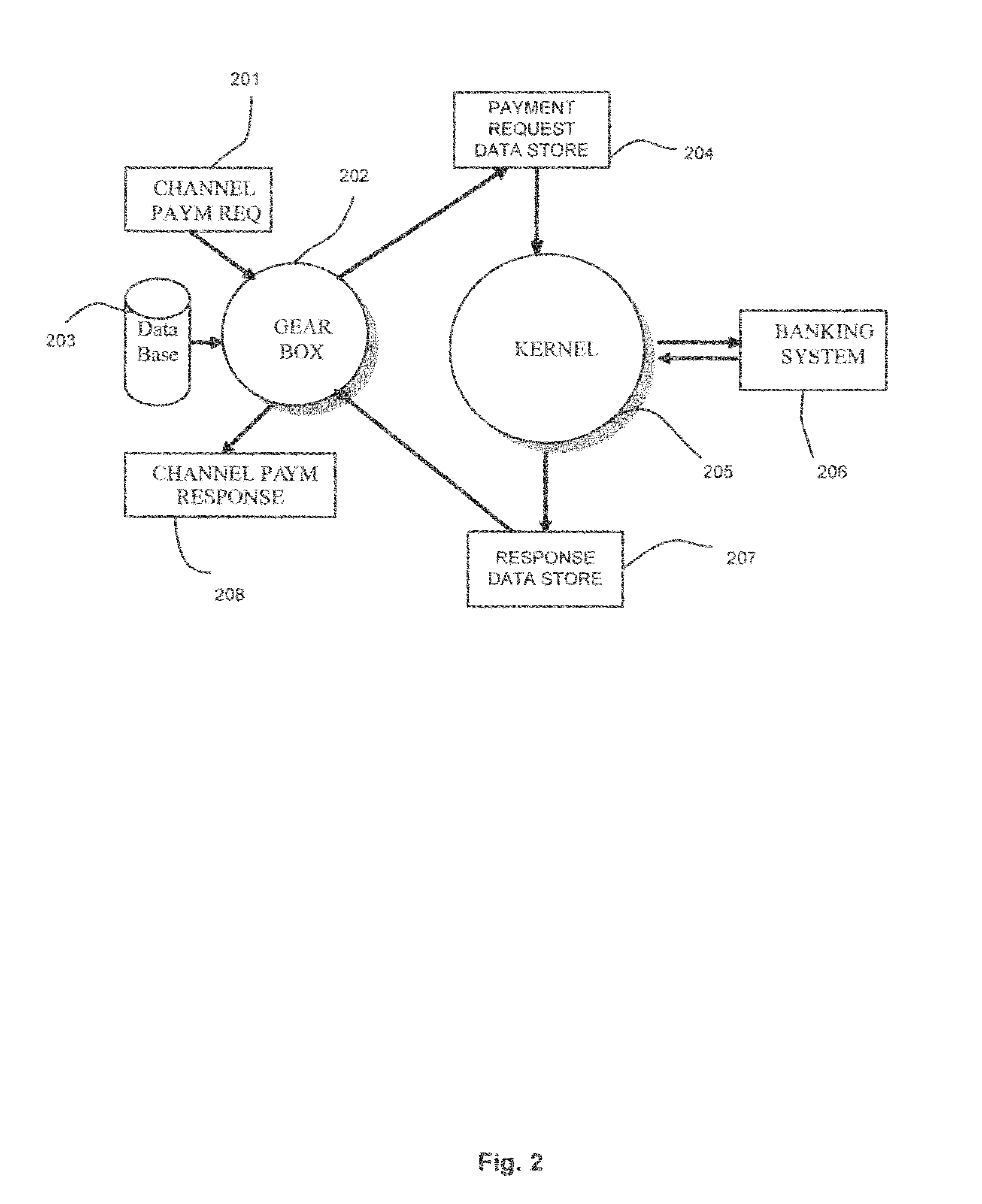

System and methods for a multi-channel payment platform

The platform executes secure payment transactions between customers and registered merchants by using remote terminals. When the user authorizes his / her payment data (e.g. using a credit card) to be permanently stored in the central system, it is possible to extend payment functionality to other remote devices (e.g. a mobile phone, a cable-TV, a touch-tone telephone . . . etc). By remotely placing the payment functionality on the central system, payment data are never managed by the merchant or by the user. The system comprises a central computer information system and a number of remote terminals used for executing payment requests. When receiving a payment request, the platform recognizes the user, retrieves from its database his method of payment, the merchant account number and conducts the real payment transaction interacting with external financial institutions.

Owner:PILO BRUNO

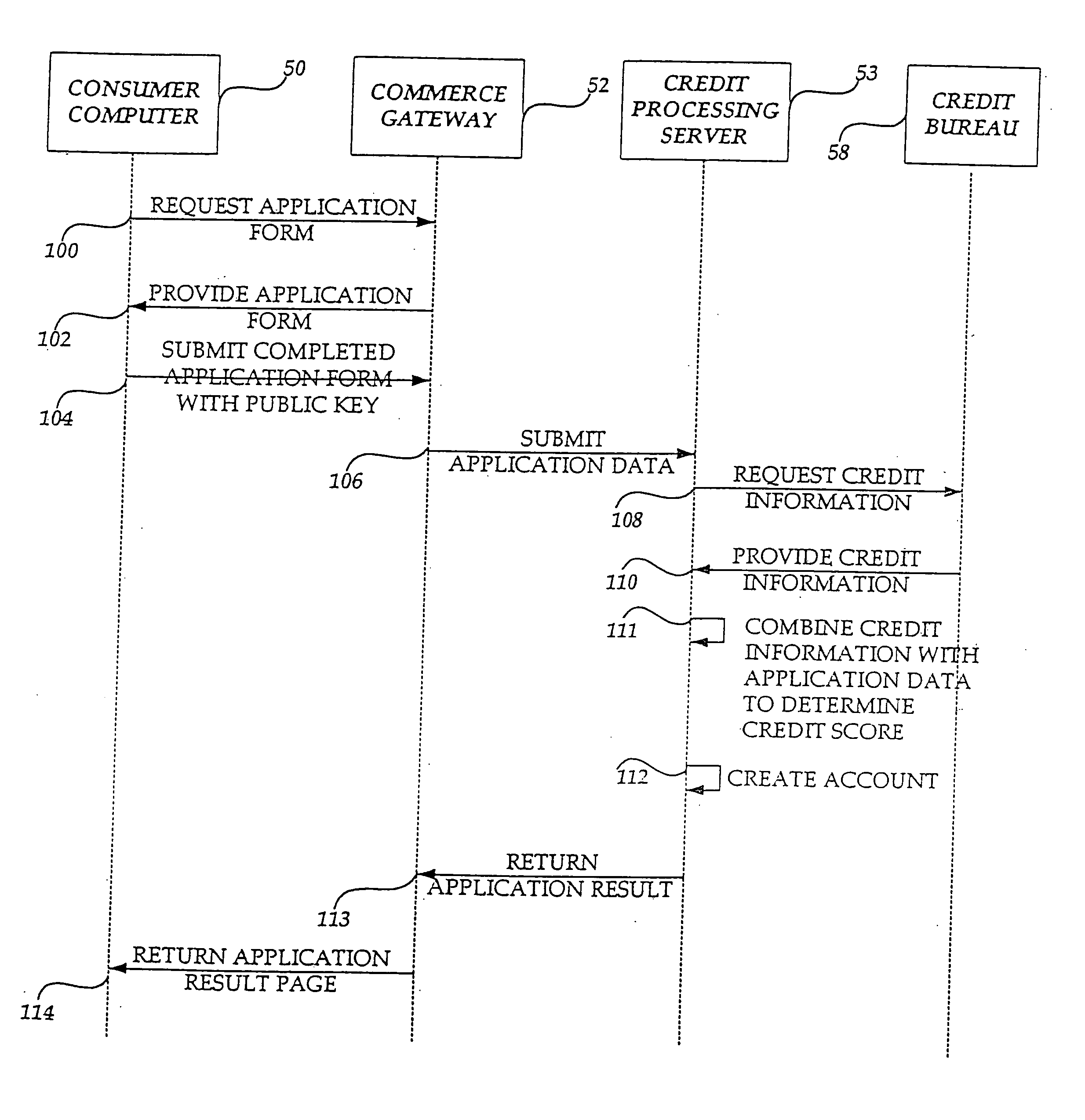

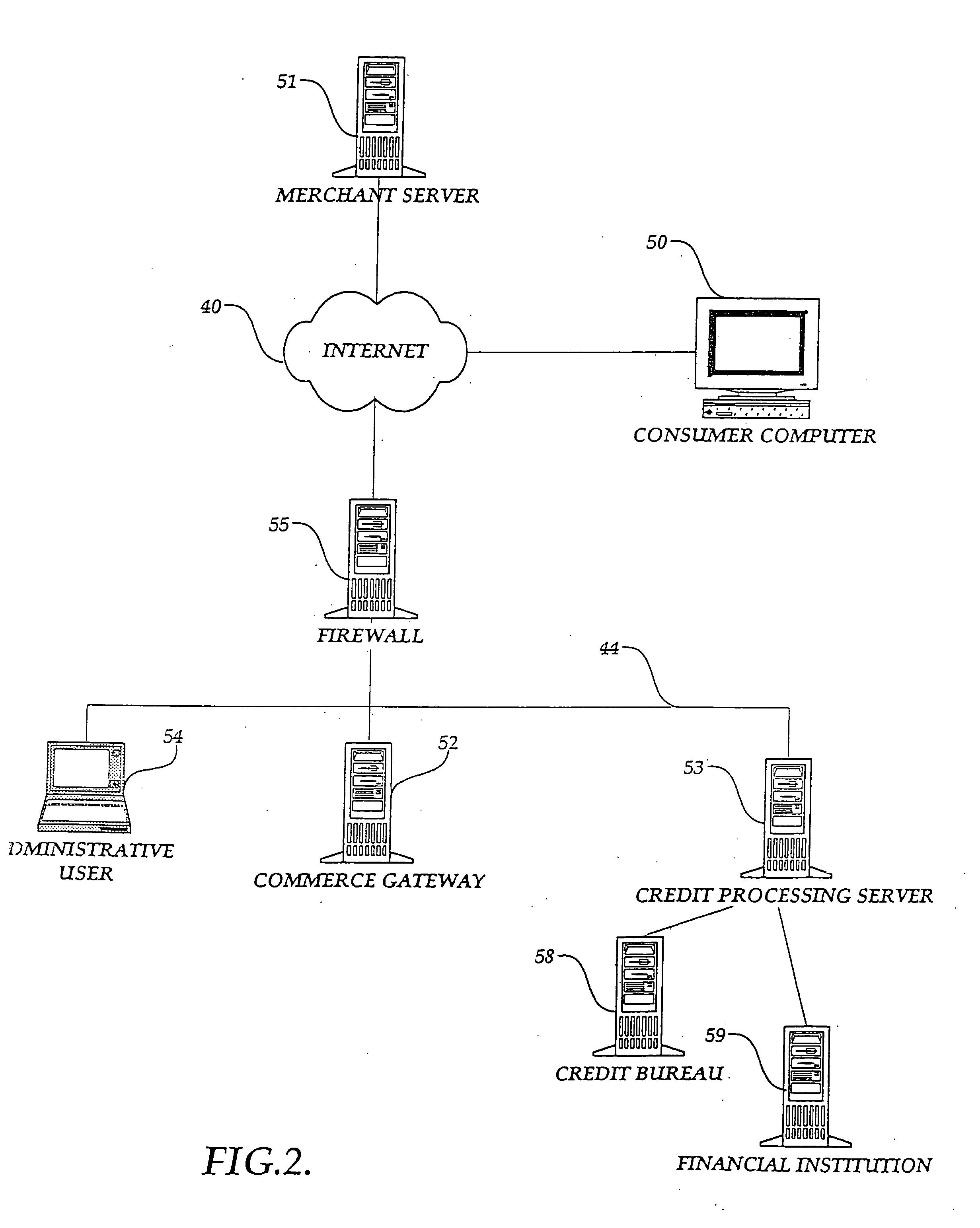

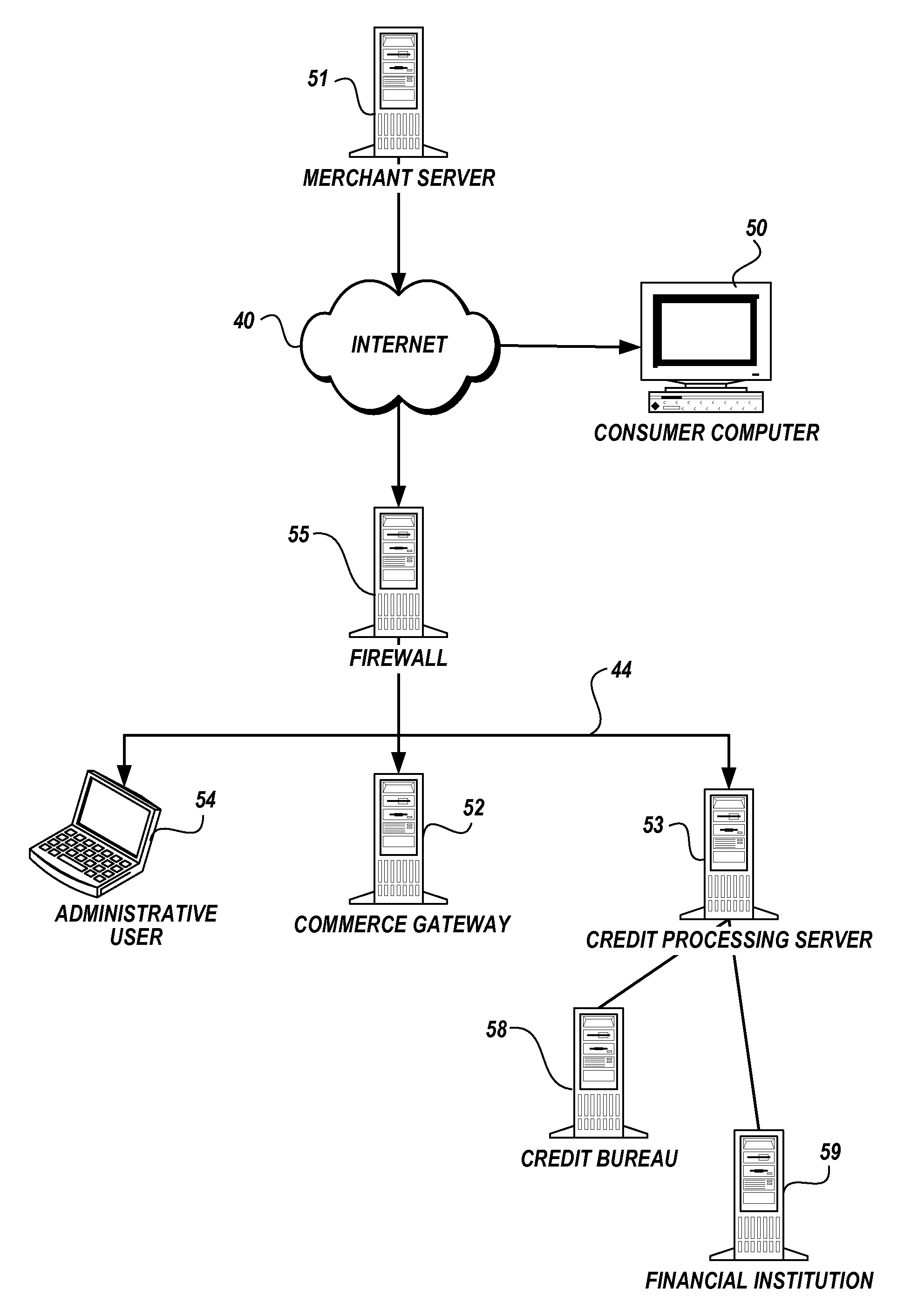

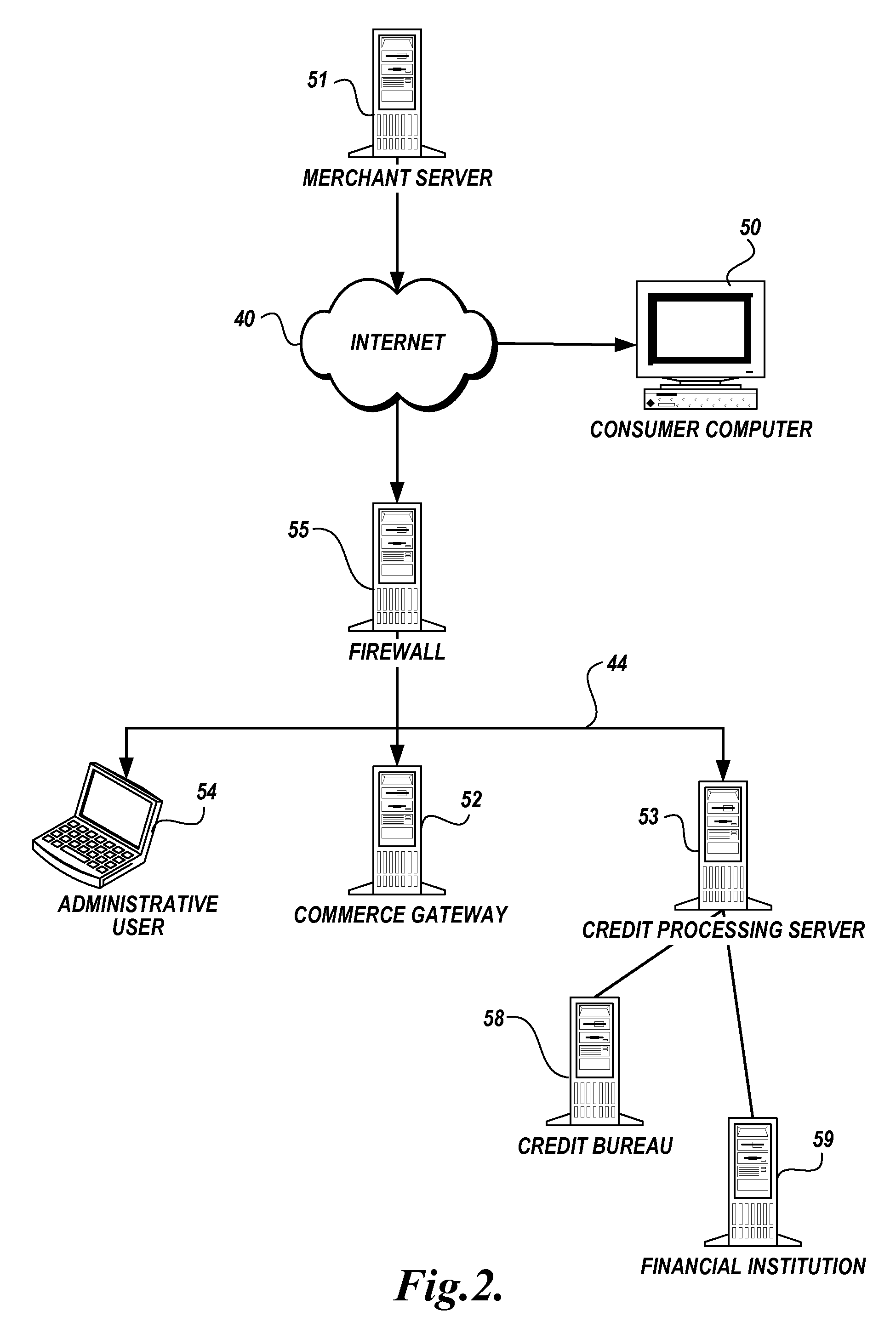

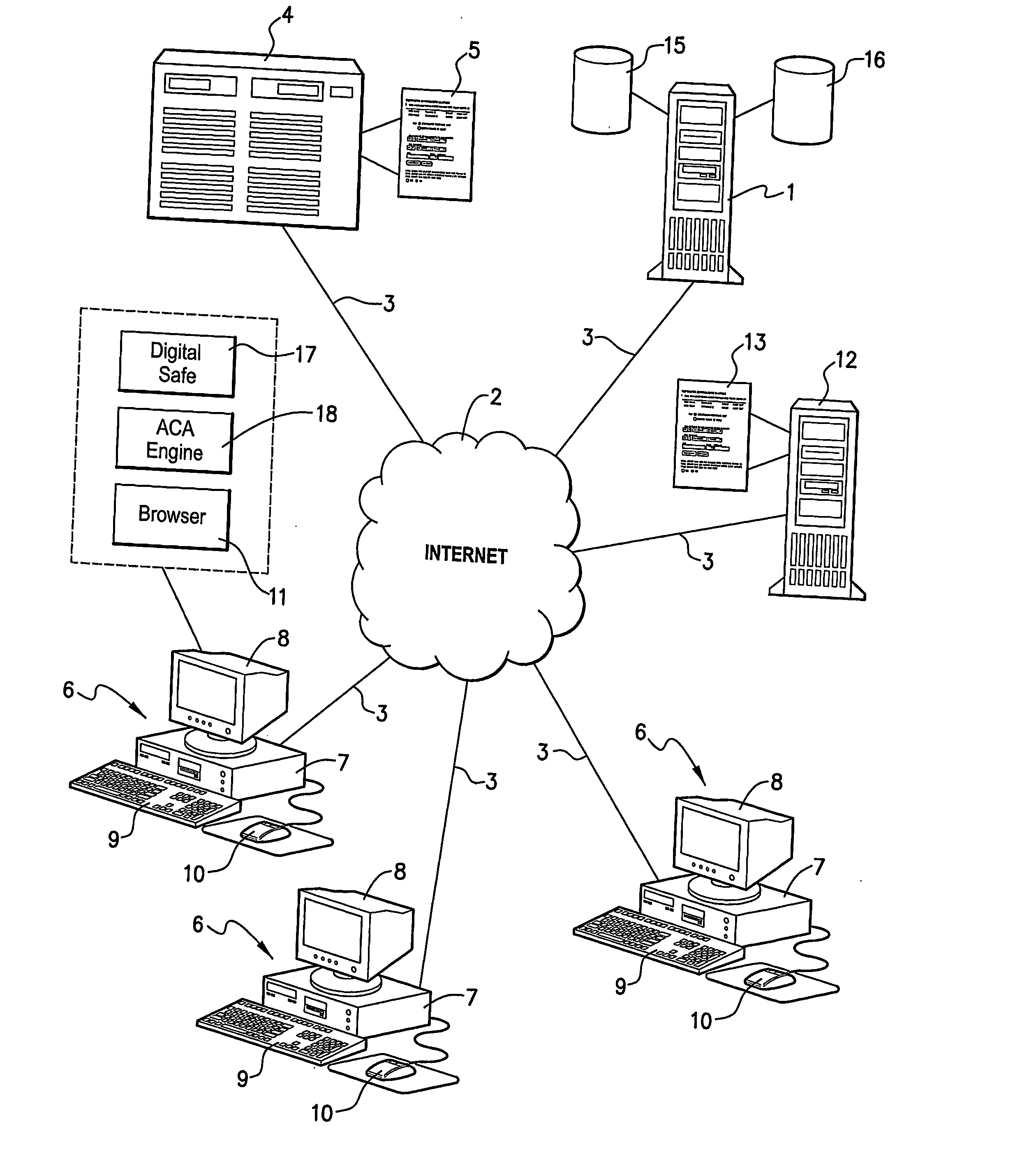

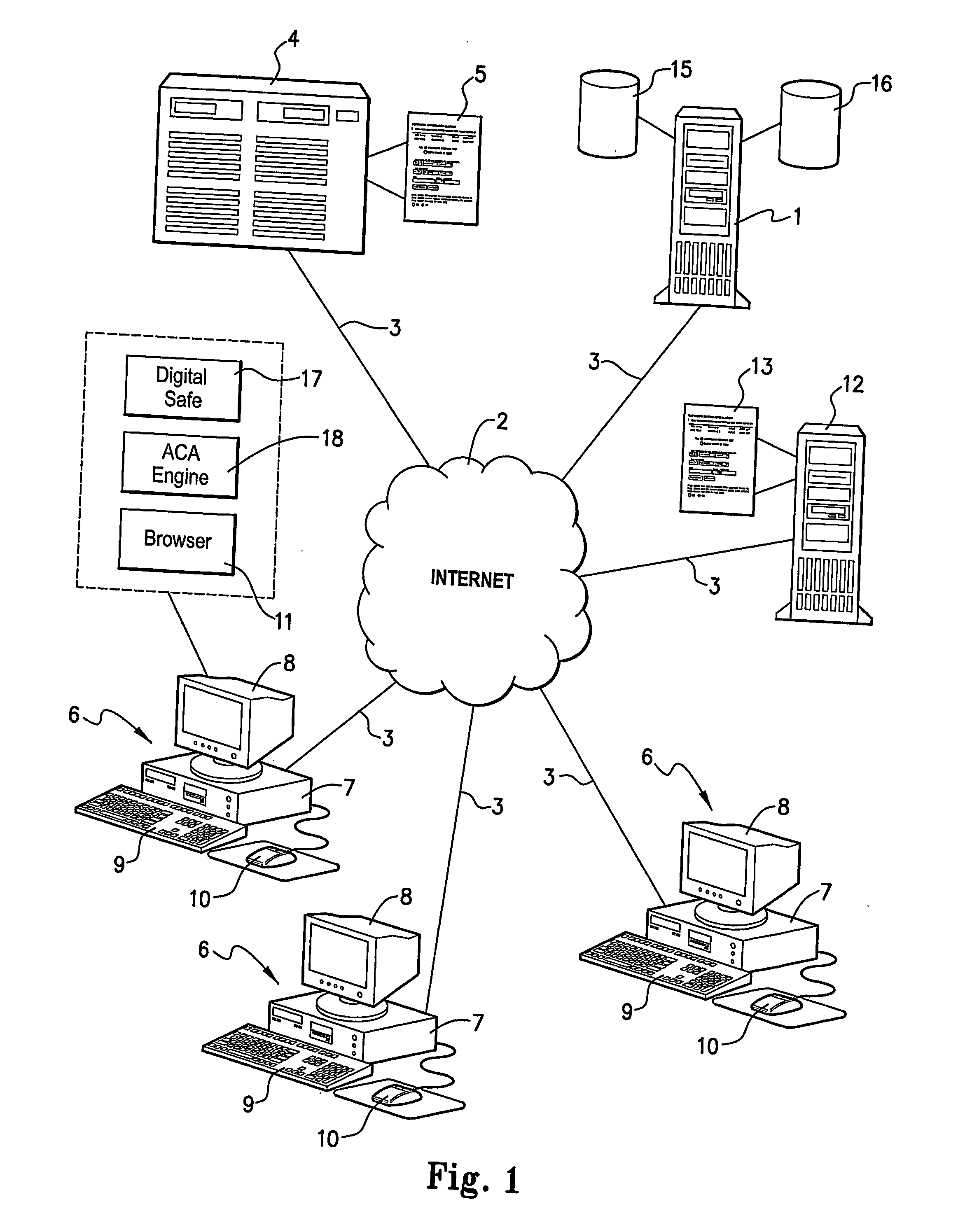

Method and apparatus for ordering goods, services and content over an internetwork using a virtual payment account

A virtual payment card system for ordering and paying for goods, services and content over an internetwork is disclosed. The virtual payment card system comprises a commerce gateway component (52) and a credit processing server component (53). The virtual payment card system is a secure closed system comprising registered merchants and consumers. A consumer becomes a registered participant by applying for a virtual payment card. Likewise, a merchant becomes registered by applying for a merchant account. A consumer can instantly open an account on-line. That is, the credit processing component (53) immediately evaluates the consumer's virtual payment card application and assigns a credit limit to the account. Once an account is established, a digital certificate is stored on the registered participant's computer. The consumer can then order a product, i.e., goods, services or content from a merchant and charge it to the virtual payment card. When the product is shipped, the merchant notifies the commerce gateway component (52), which in turn notifies the credit processing server which applies the charges to the consumer's virtual card account. The consumer can settle the charges using a prepaid account, a credit card, or by using reward points earned through use of the virtual payment card. A consumer may create sub-account that have additional limitations imposed on the owner of the sub-account.

Owner:STRIPE INC

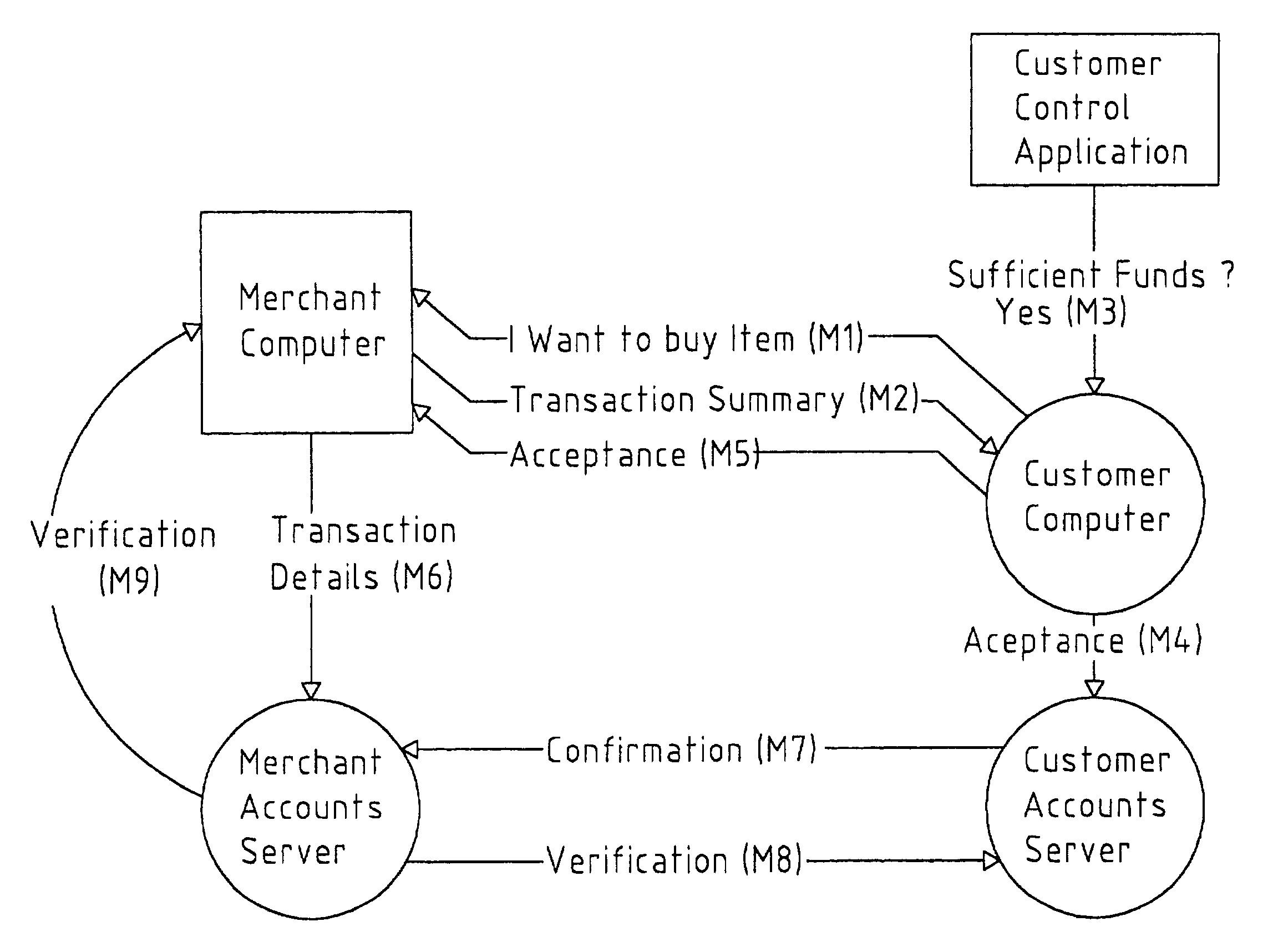

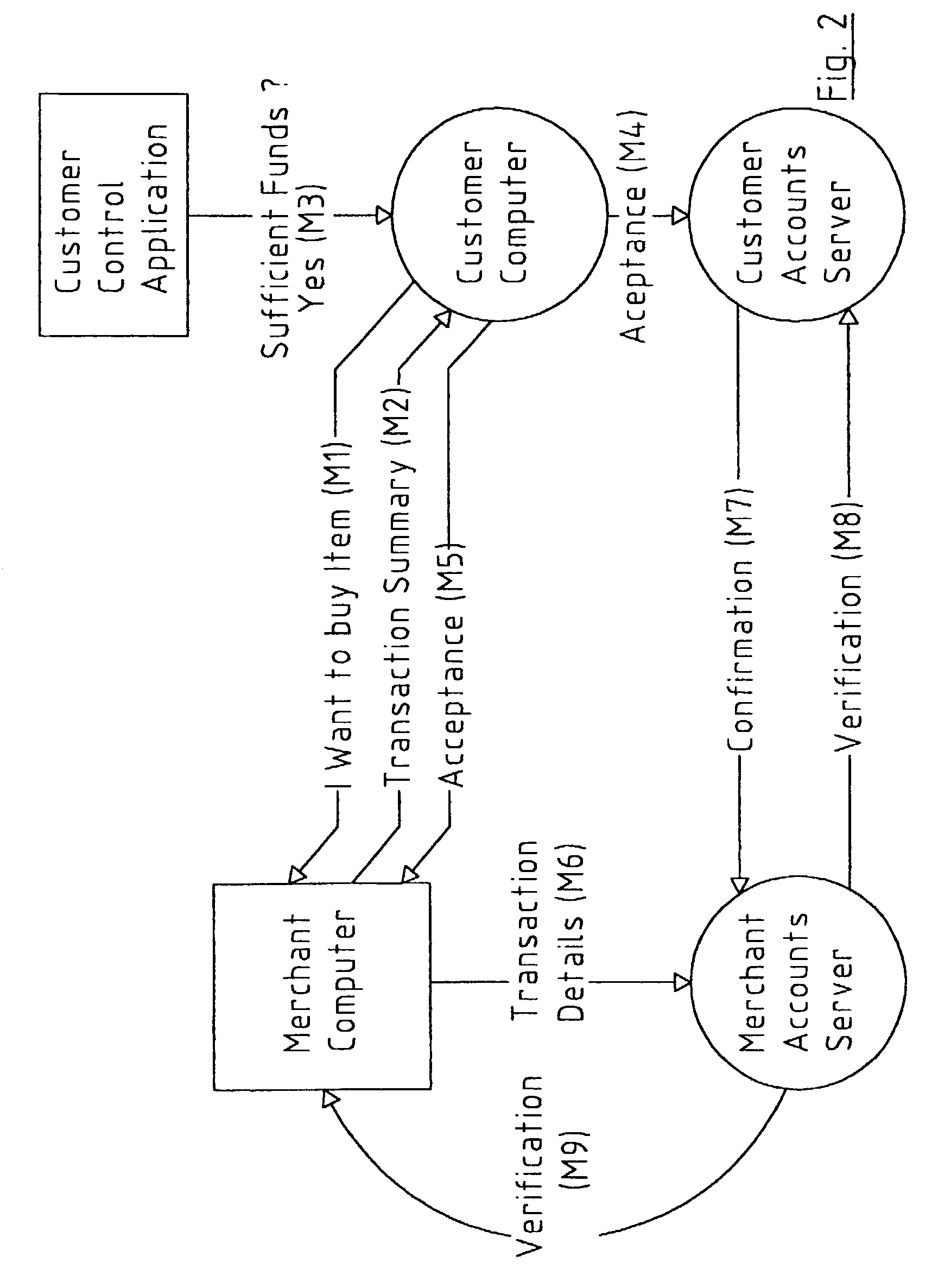

Network-based system

A transaction settlement system and method for internet and other trading over a telecommunications network. Customer computers and merchant computers are connected to customer account servers and merchant account servers respectively, the former maintains a customer account and conducts the financial aspects of the transaction with the merchant server without revealing the customers identity. The sequence of the messages are such that once in message M4, the customer computer instructs the customer accounts server to accept the transaction and the customer accounts server accepts it, the customer accounts server deals with the merchant accounts server to settle the account in accordance with agreed procedures. The merchant can have surely of payment. There is also provided methods to deliver coupons, e.g. discount coupons and to ship goods with anonymity.

Owner:INTERNET PAYMENTS PATENTS

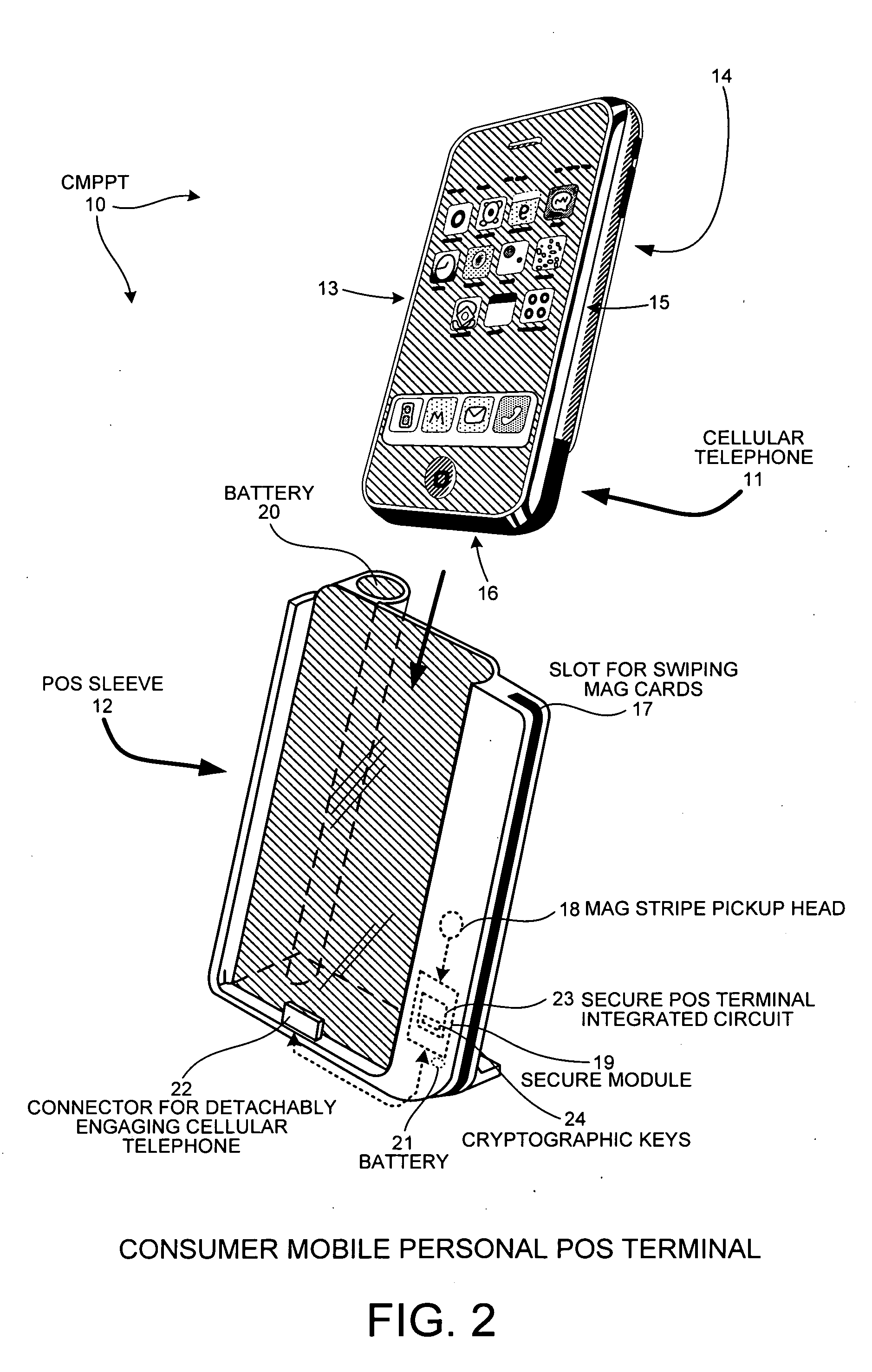

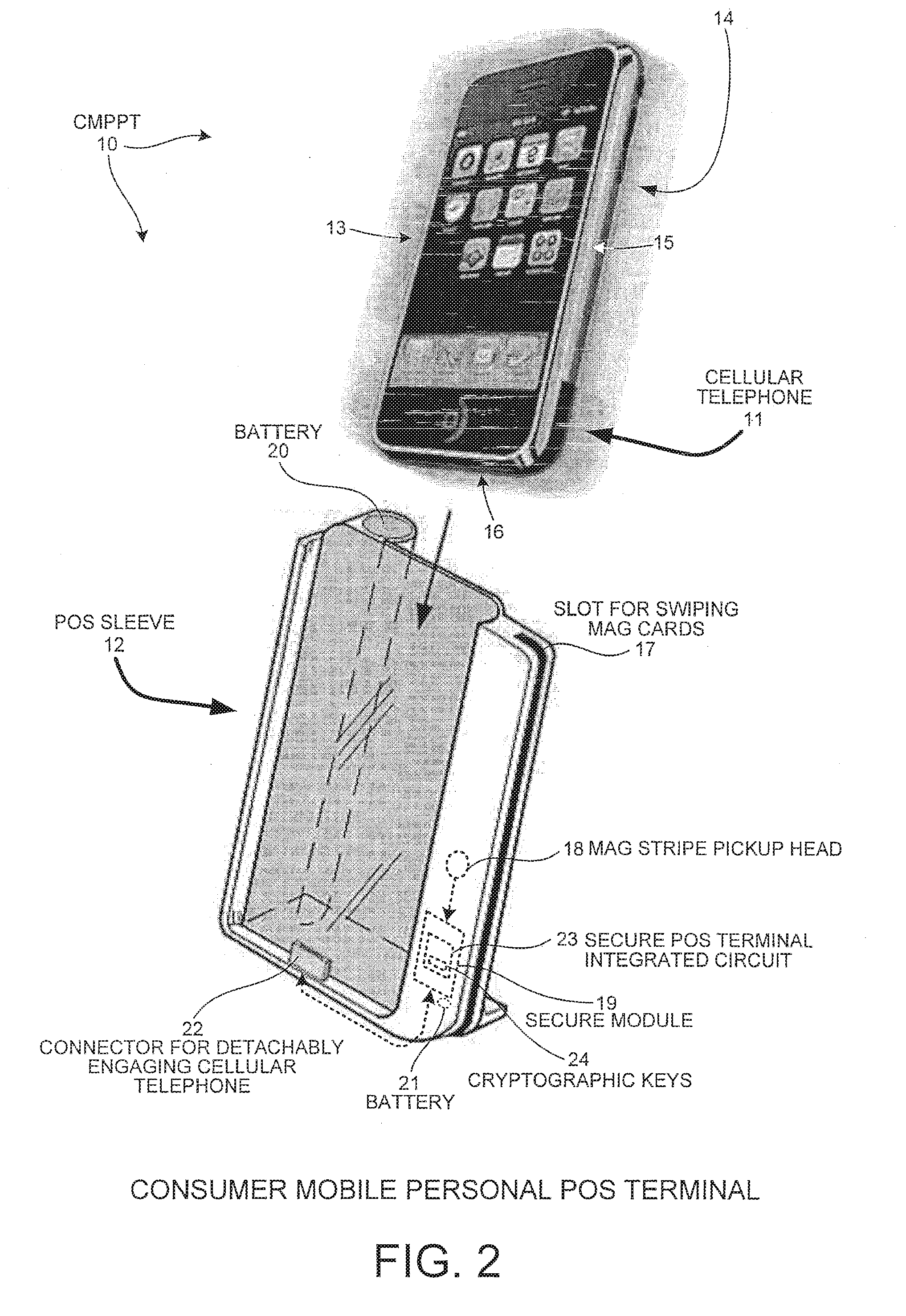

Mobile personal point-of-sale terminal

InactiveUS20100057620A1Acutation objectsHand manipulated computer devicesMerchant accountFinancial transaction

A customer mobile personal point-of-sale terminal (CMPPT) includes a Point-Of-Sale (POS) sleeve portion that slidingly engages, and couples to, a cellular telephone. The cellular telephone is used to communicate encrypted information between a financial transaction verification entity (FTVE) and the POS sleeve portion. The sleeve portion includes a mechanism for reading in a merchant account number at the point-of-sale, and for communicating in a secure encrypted fashion with the FTVE via the cellular telephone portion. Rather than a customer entering sensitive financial information into a merchant's POS terminal (MPT) and trusting the merchant with such information, merchant information is entered into the CMPPT. The CMPPT initiates a transaction by sending the customer's account information and the merchant information to the FTVE. The FTVE receives information about the transaction directly from the MPT. The FTVE verifies the transaction, and after authorization, the FTVE forwards approval codes to the CMPPT and MPT.

Owner:MAXIM INTEGRATED PROD INC

Secure Online Push Payment Systems and Methods

Some embodiments provide a payment system that involves mobile applications, merchant Points-of-Sale (POS's), and a back-end. The back-end registers a mobile application for use by a user and a user PIN to complete a transaction via the mobile application. The back-end also registers identifiers to uniquely identify the merchant POS's. The user performs a check-in to a merchant POS by submitting the unique encoded identifier of the merchant POS to the back-end using the mobile application. The merchant can then invoice the user by selecting the corresponding check-in of that user and uploading an invoice for that check-in to the back-end. The back-end provides the invoice to the user via the mobile application. The user enters his / her PIN in the mobile application to approve payment for the transaction and the back-end completes the transfer of funds from a user account to a merchant account.

Owner:UAB WORAPAY

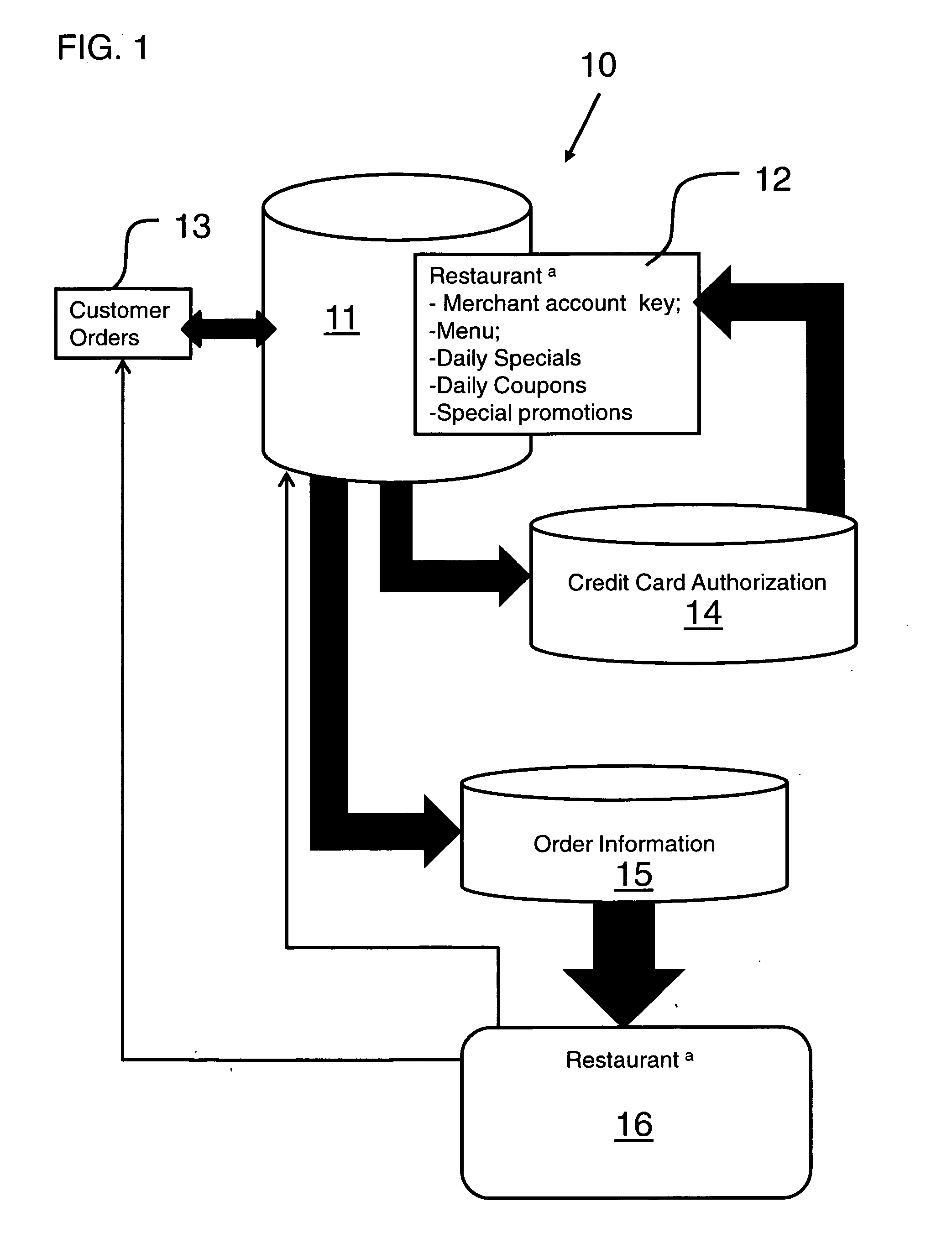

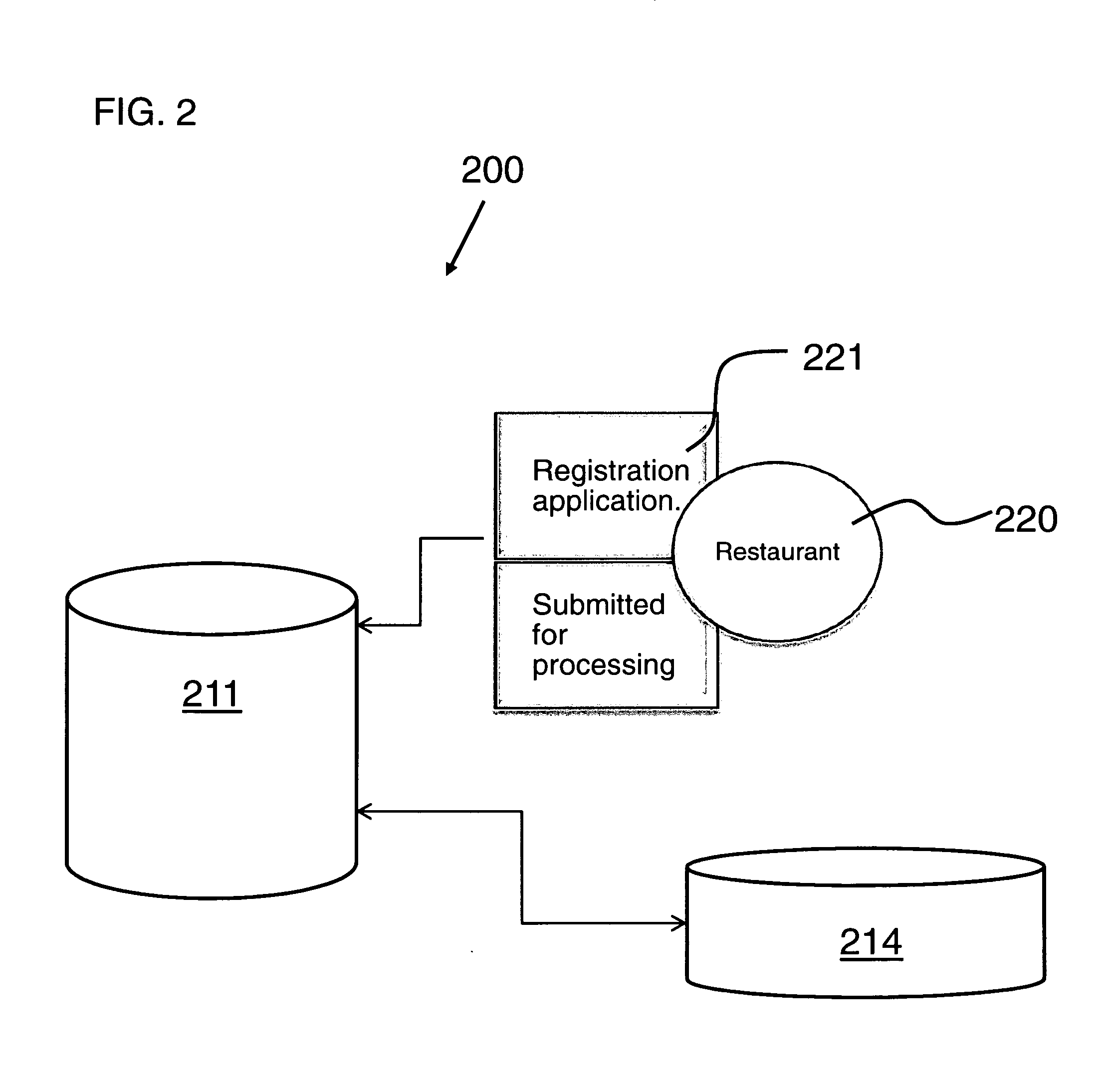

Online food ordering system and method

Restaurants register for an online food ordering system and method to have their menus presented on the online system. Registration is accomplished by payment of a fixed registration fee. A merchant account is created for each restaurant. The merchant account is associated with a unique account key that includes a local delivery indicator and direct payment receivable account information facilitating direct payment to the restaurant's account. A first server is appointed for receiving orders from customers. The first server includes a data storage device having menu items and information from each of the restaurants and each of the unique account keys associated with each restaurant. In communication with the first server are second and third servers for processing payments and transmitting orders to the restaurant for processing and fulfillment. An order confirmation means is further provided for notifying the customer upon submission of the order to the restaurant along with estimated pick-up or delivery times.

Owner:SCIFO DANILO +4

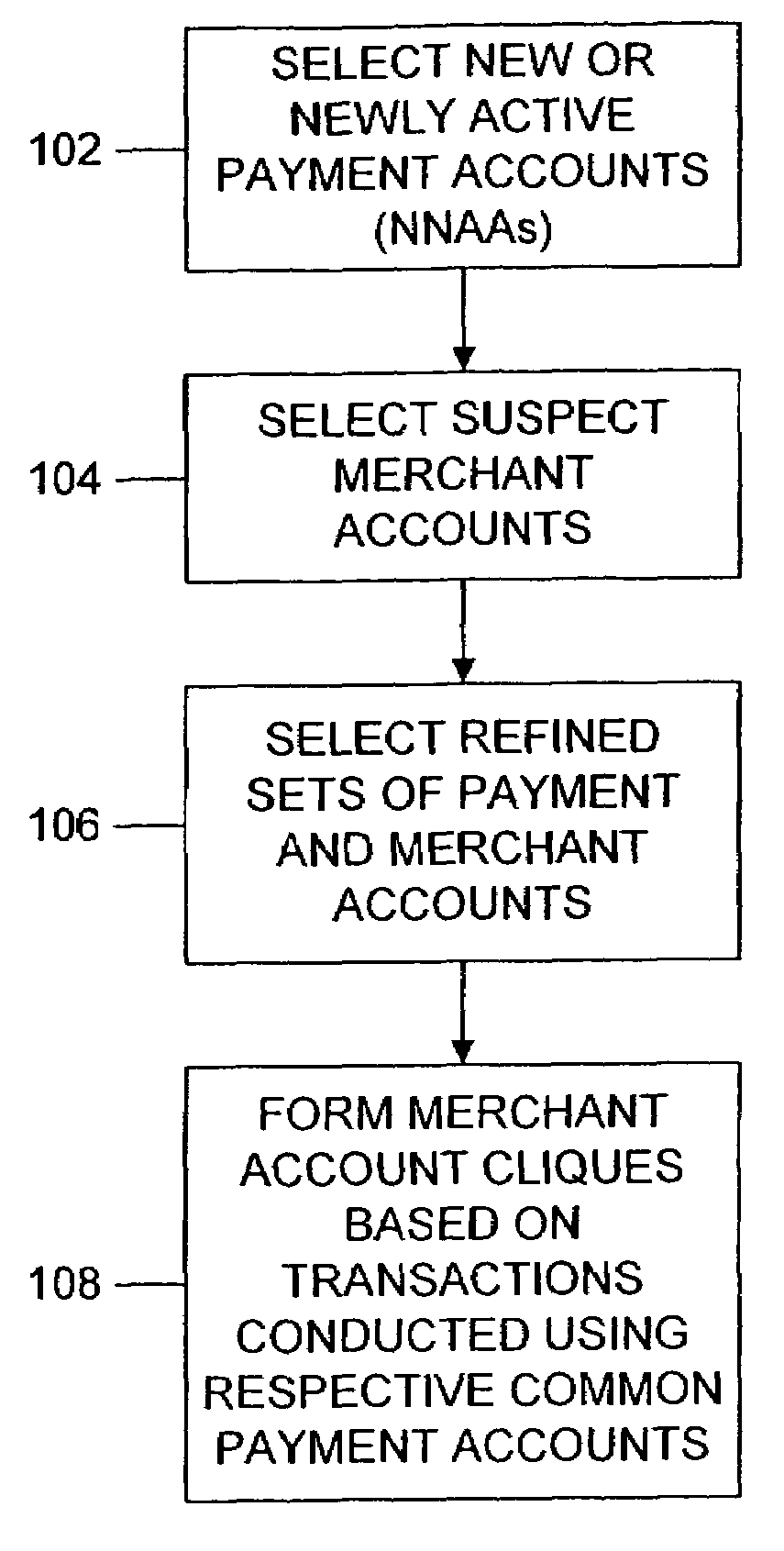

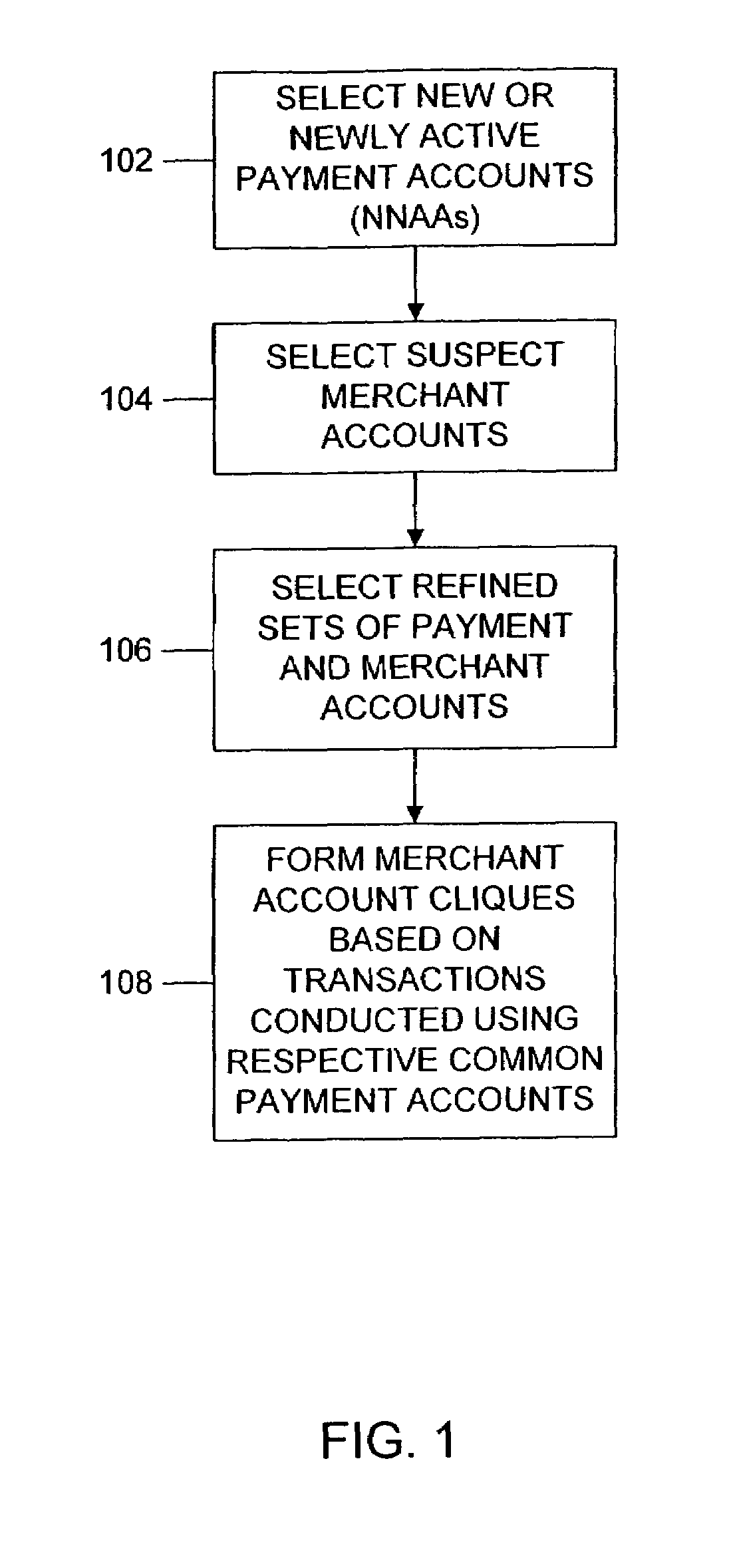

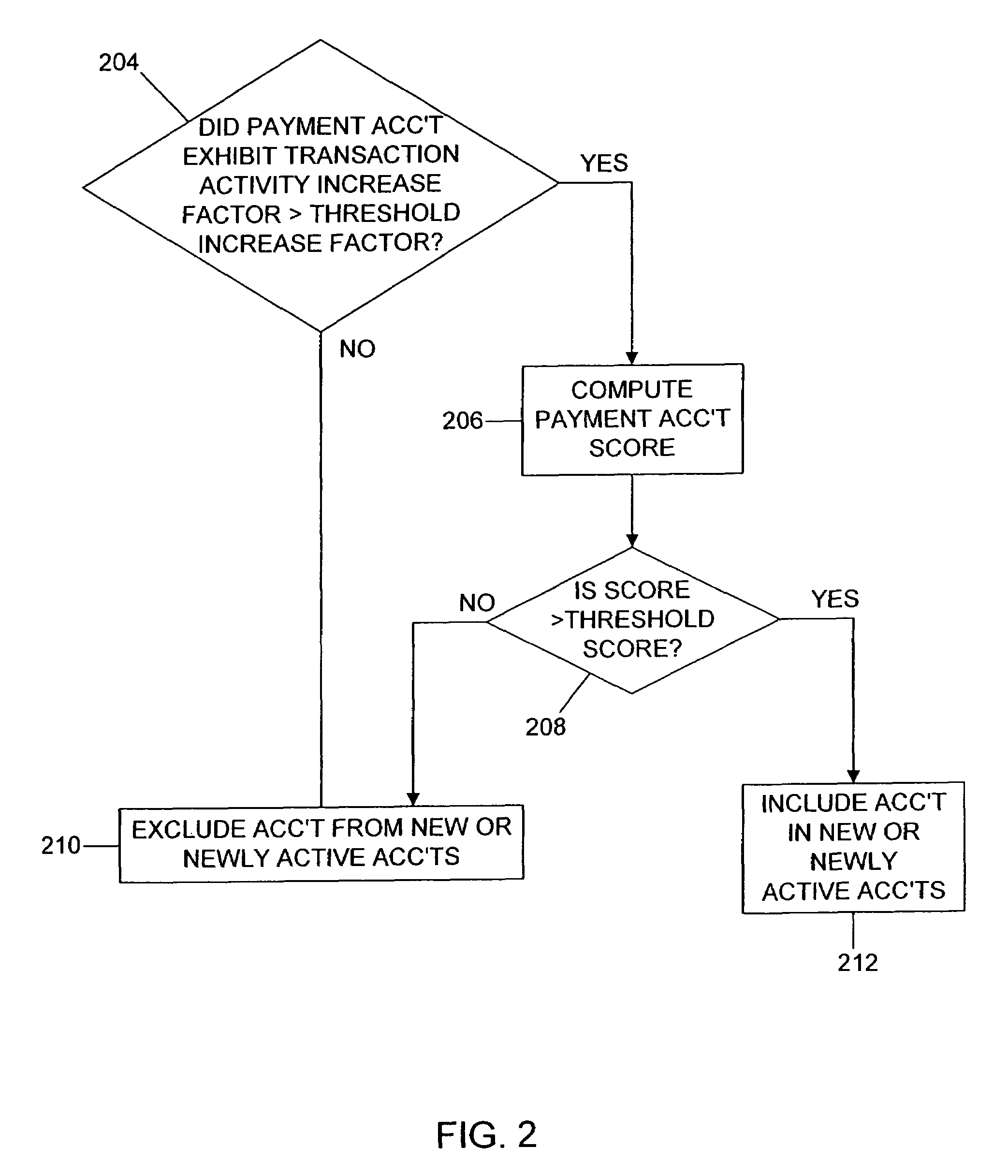

Method and system for detecting payment account fraud

InactiveUS7428509B2Increase in high-value transaction activityFinanceBuying/selling/leasing transactionsCredit cardInternet privacy

A method and system for identifying patterns of payment account (e.g., credit card account) transactions that have a high probability of being part of a fraudulent scheme. Certain merchant accounts and payment accounts may have been obtained under false pretenses. For example, the payment accounts may have been obtained with the intention of never paying the bills with a true instrument. Merchant accounts may have been obtained in order to perform transactions either with payment accounts obtained under false pretenses or with stolen payment account information. To detect suspicious patterns of account activity, payment accounts that are new or exhibit a substantial increase in account activity are first identified. Merchant accounts having an unusually large number or value of transactions with such new or newly active payment accounts are also identified. Such merchants and payment accounts can then be subjected to further scrutiny by the affected institutions.

Owner:MASTERCARD INT INC

Method and system for facilitating electronic funds transactions

InactiveUS20070045407A1Reduce transaction costsMaintaining measureComplete banking machinesFinanceInformation sharingMerchant account

Owner:KIOBA PROCESSING LLC

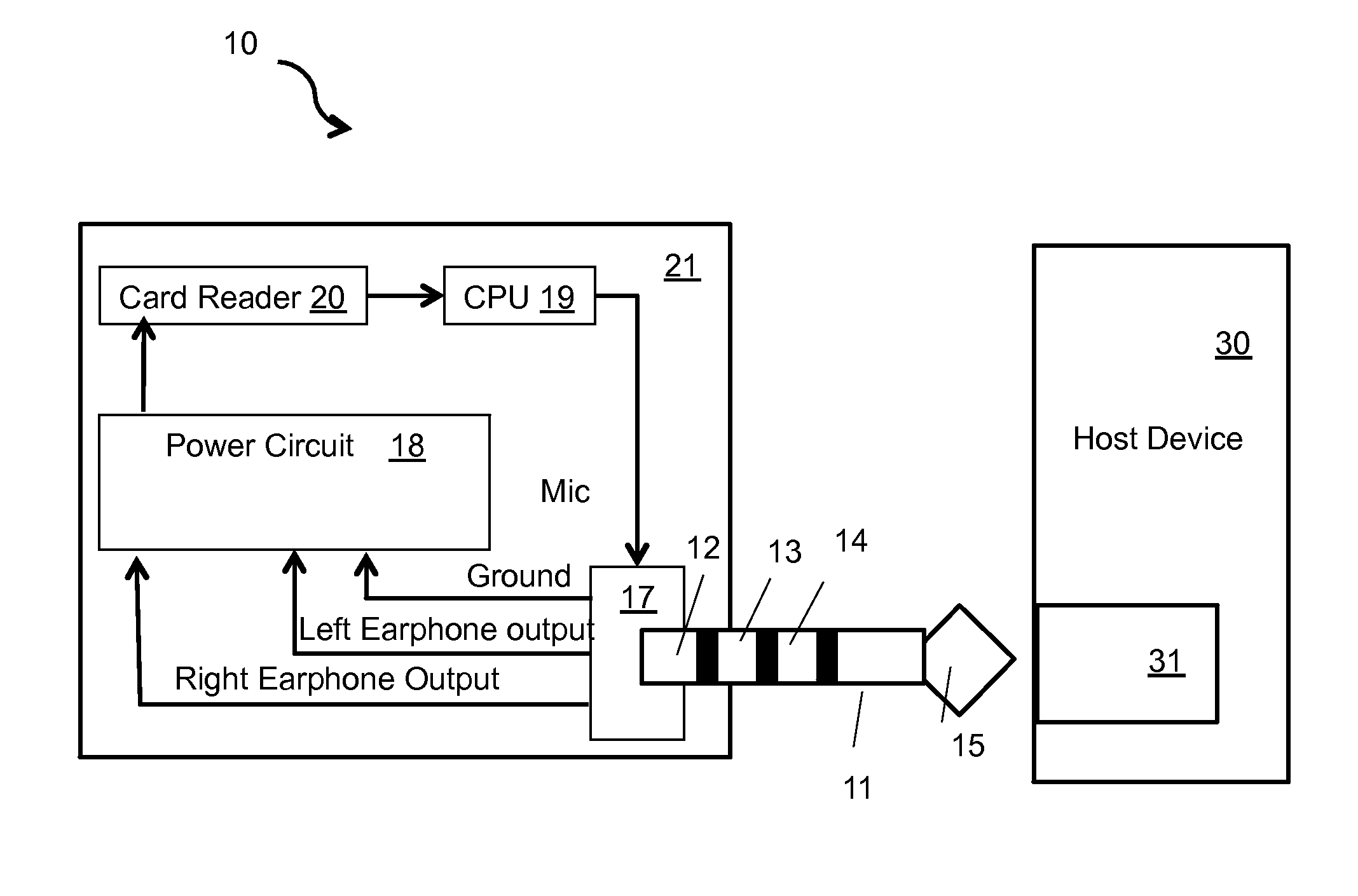

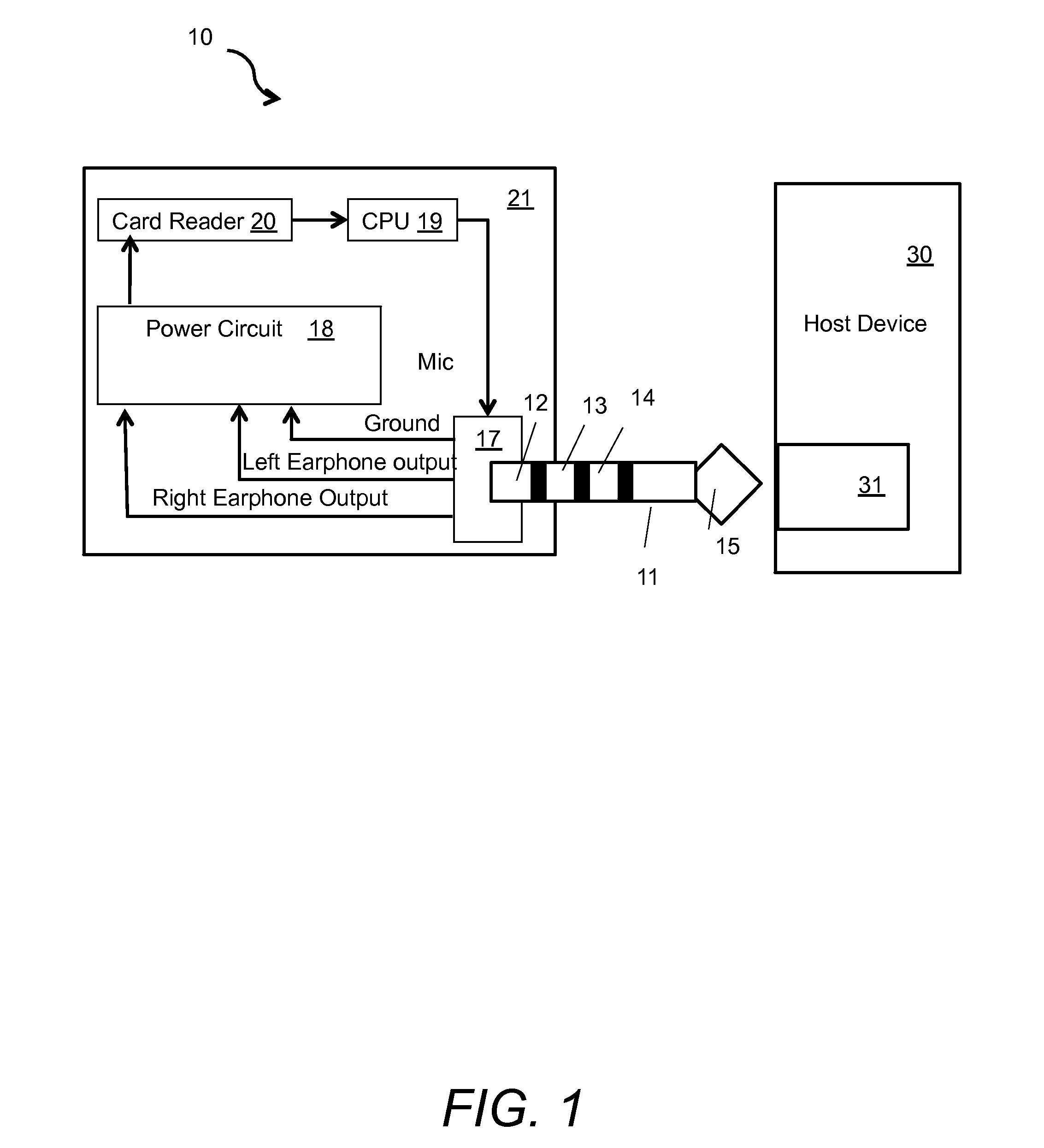

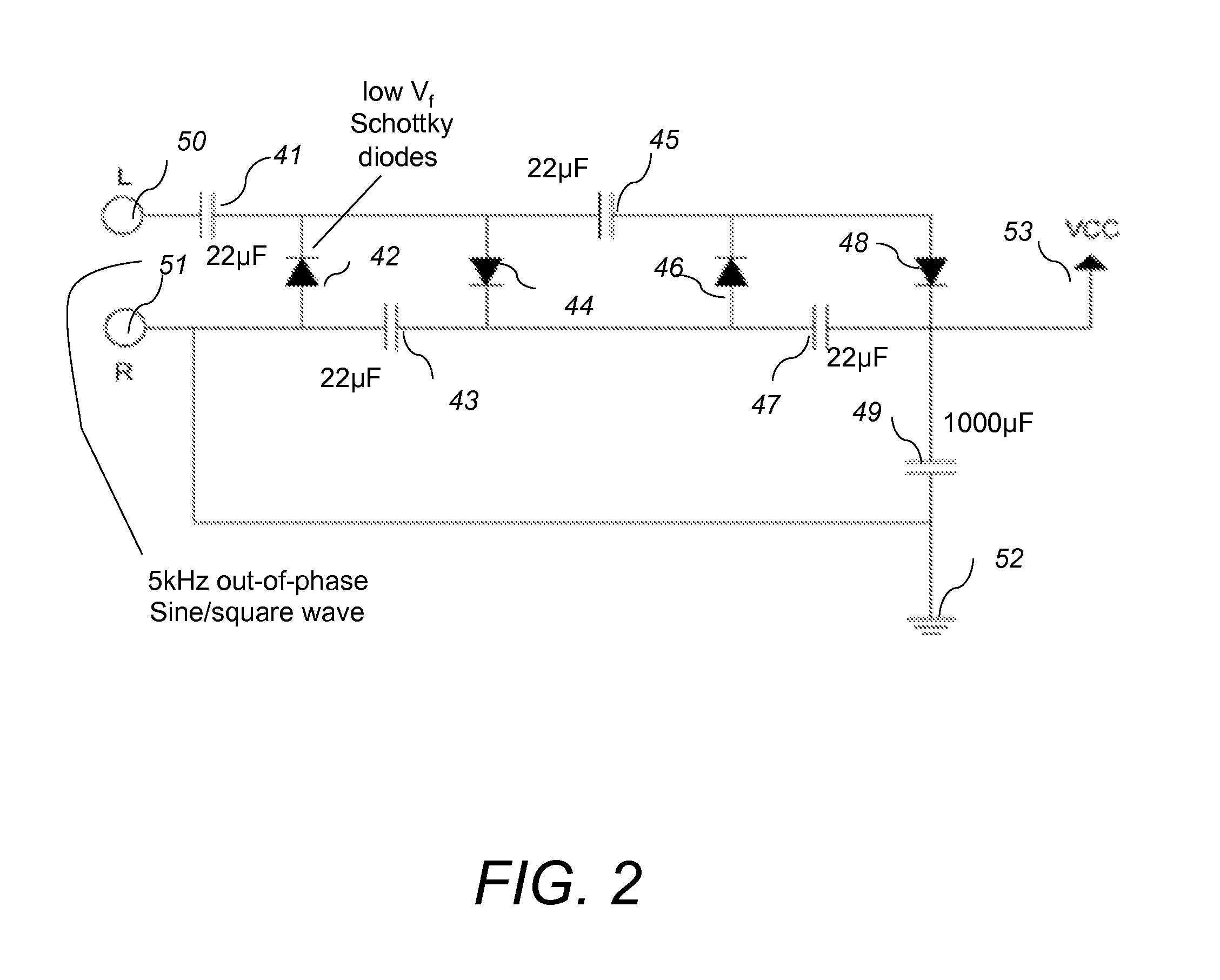

Payment card terminal dongle for communications devices

A dangle, which plugs into the audio / earpiece jack of host devices, allows them to accept payment cards as a point of sale (POS) terminal. It contains a magnetic stripe (magstripe) card reader, a smart card reader, and / or a proximity card reader (reader(s)); a microprocessor or microcontroller (CPU); and a circuit for drawing power from a digital audio signal (power circuit). Payment card data is collected by the reader(s), passed to the CPU where it is encrypted, encoded, and modulated, sent to the host device through the Microphone input contact of the audio / earpiece jack, then transmitted via one the host device's networks to a merchant account provider for processing. A digital audio signal, constantly generated by the host device, provides power to the dongle via the power circuit. The power circuit converts the digital audio signal to stable DC power with the appropriate voltage for powering the dongle's other components.

Owner:STRIPE INC

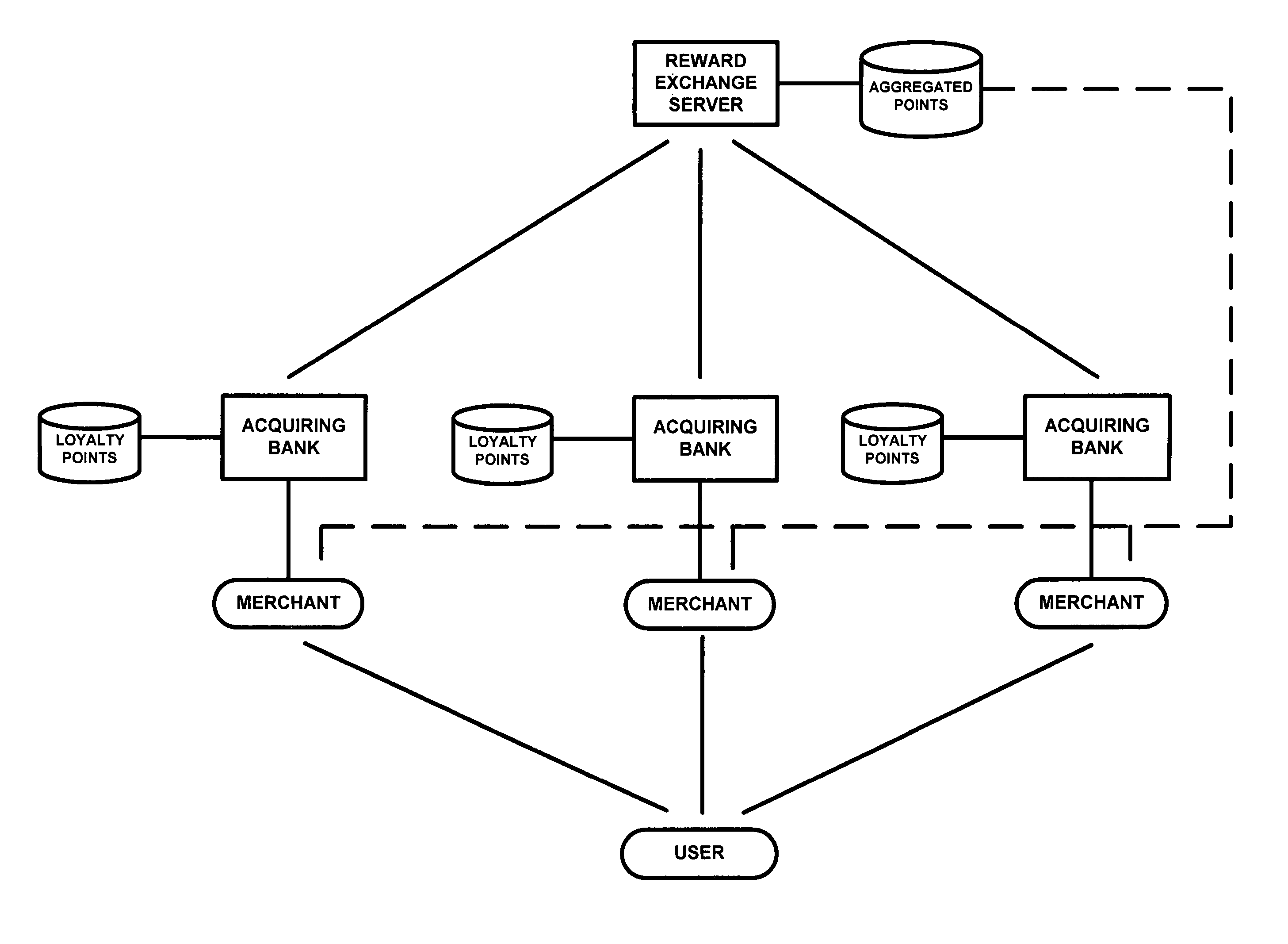

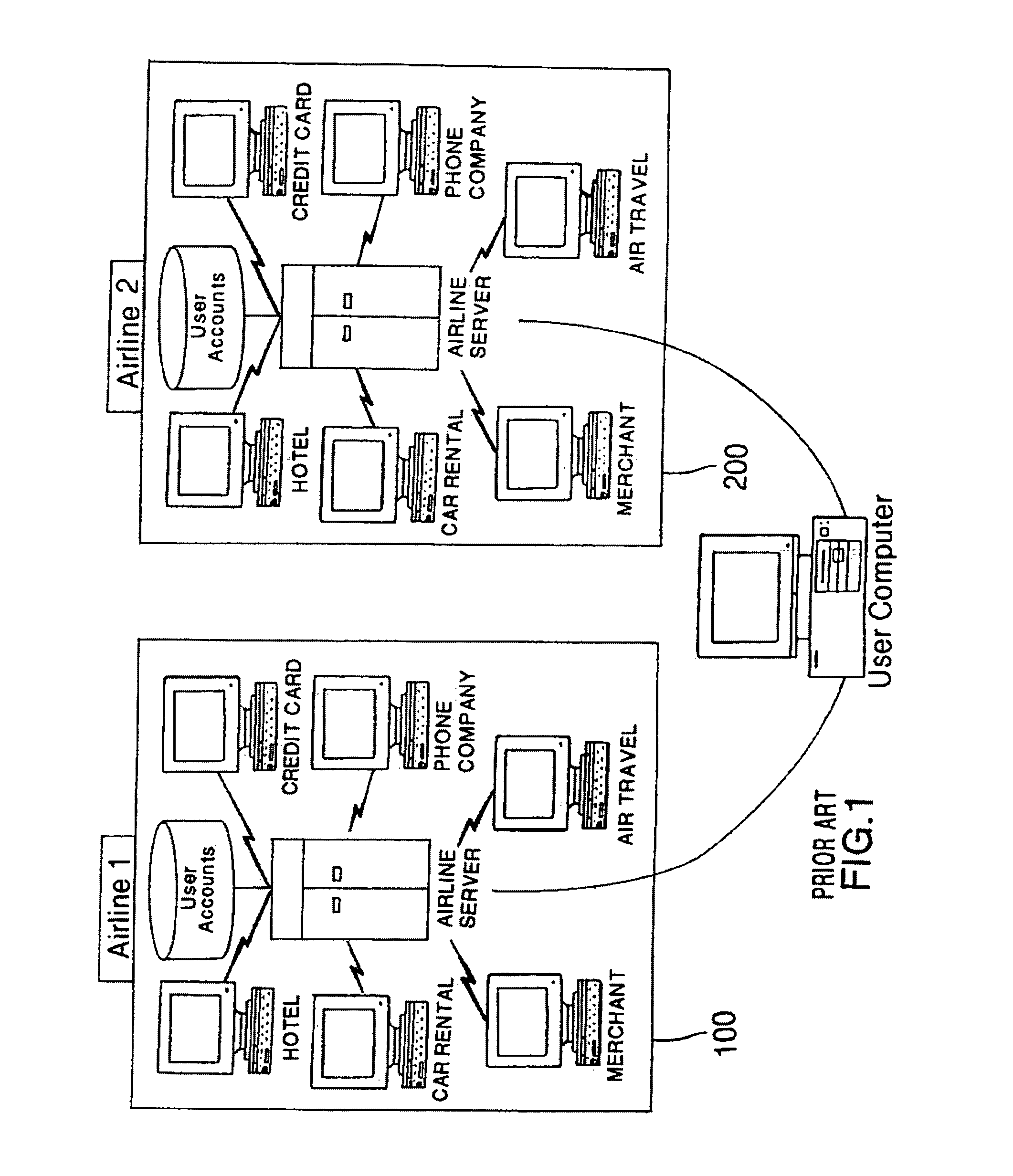

Method and system for issuing, aggregating and redeeming rewards based on merchant transactions

A loyalty or reward point system that utilizes the pre-existing infrastructure of a typical credit card network. In one embodiment, a user makes a purchase at a merchant of a product using a credit card. The merchant contacts the acquiring bank (which may be any type of financial institution but is referred to generically herein as a bank) with which it has contracted for credit card network services, and as known in the art, will get an approval or decline message after the acquiring bank contacts the issuing bank of the credit card used by the purchaser. Assuming that the purchase transaction is approved, the user is awarded loyalty points from the merchant based on the amount of the purchase (e.g. 100 points for a $100 purchase). A central server resides on the credit card network and tracks the transaction between the merchant, the acquiring bank, and the issuing bank. A reward account is maintained on the central server on behalf of the merchant and the user, and the number of reward points in the user's account for that merchant is increased accordingly. In an alternative embodiment, the user's reward points are logged in an account maintained by the acquiring bank on behalf of the merchant (with which it has a contractual relationship) and the user. The user may redeem the reward points earned from the transaction with the merchant at a later time, or may redeem the points with another merchant on the credit card network, or may aggregate those reward points with those of other merchants into a central exchange account, and then redeem the aggregated points for goods or services from any approved merchant on the network, depending on the configuration of the system.

Owner:SIGNATURE SYST

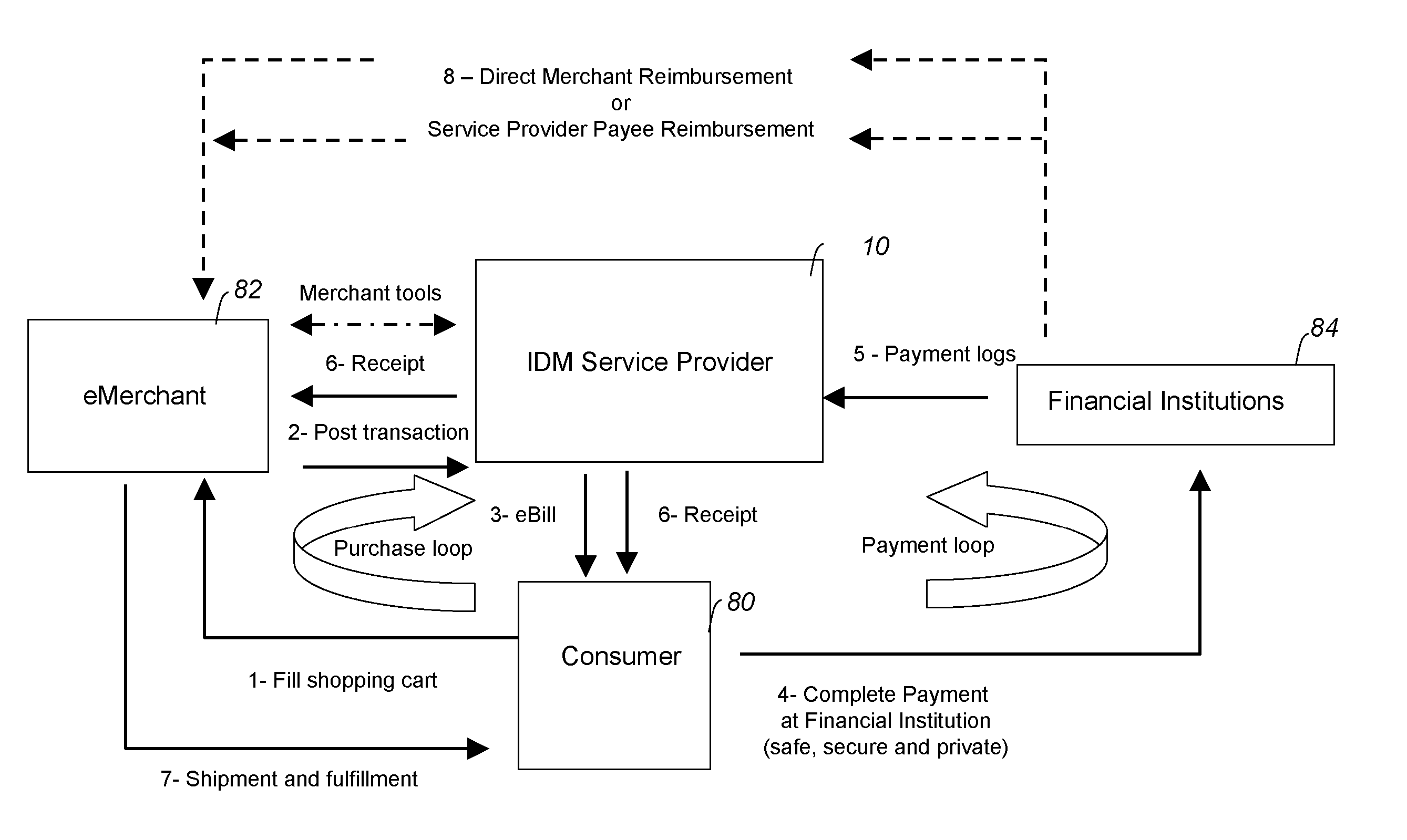

Internet payment system and method

InactiveUS20080114657A1Increase choiceLow costComplete banking machinesFinanceMerchant accountThe Internet

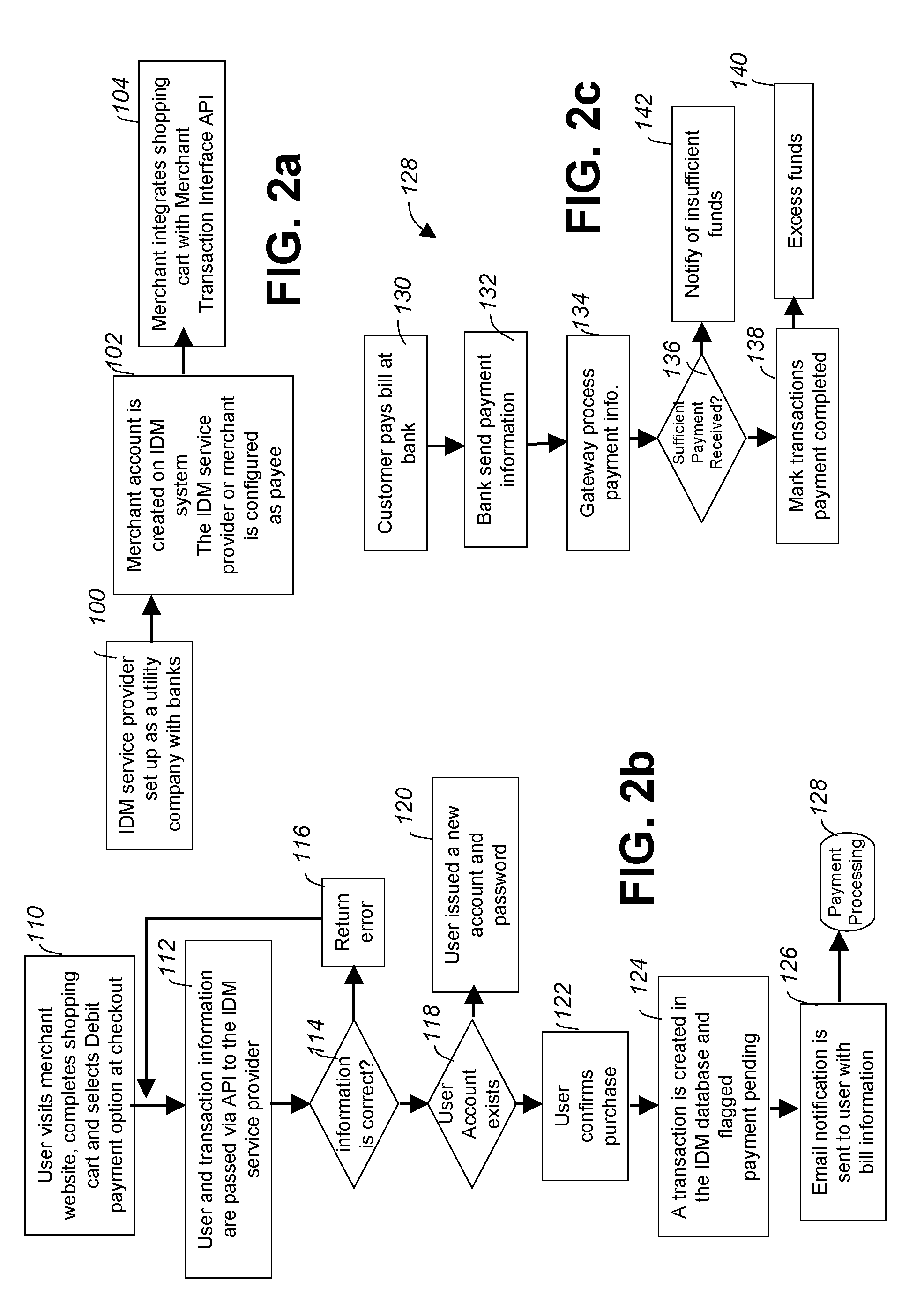

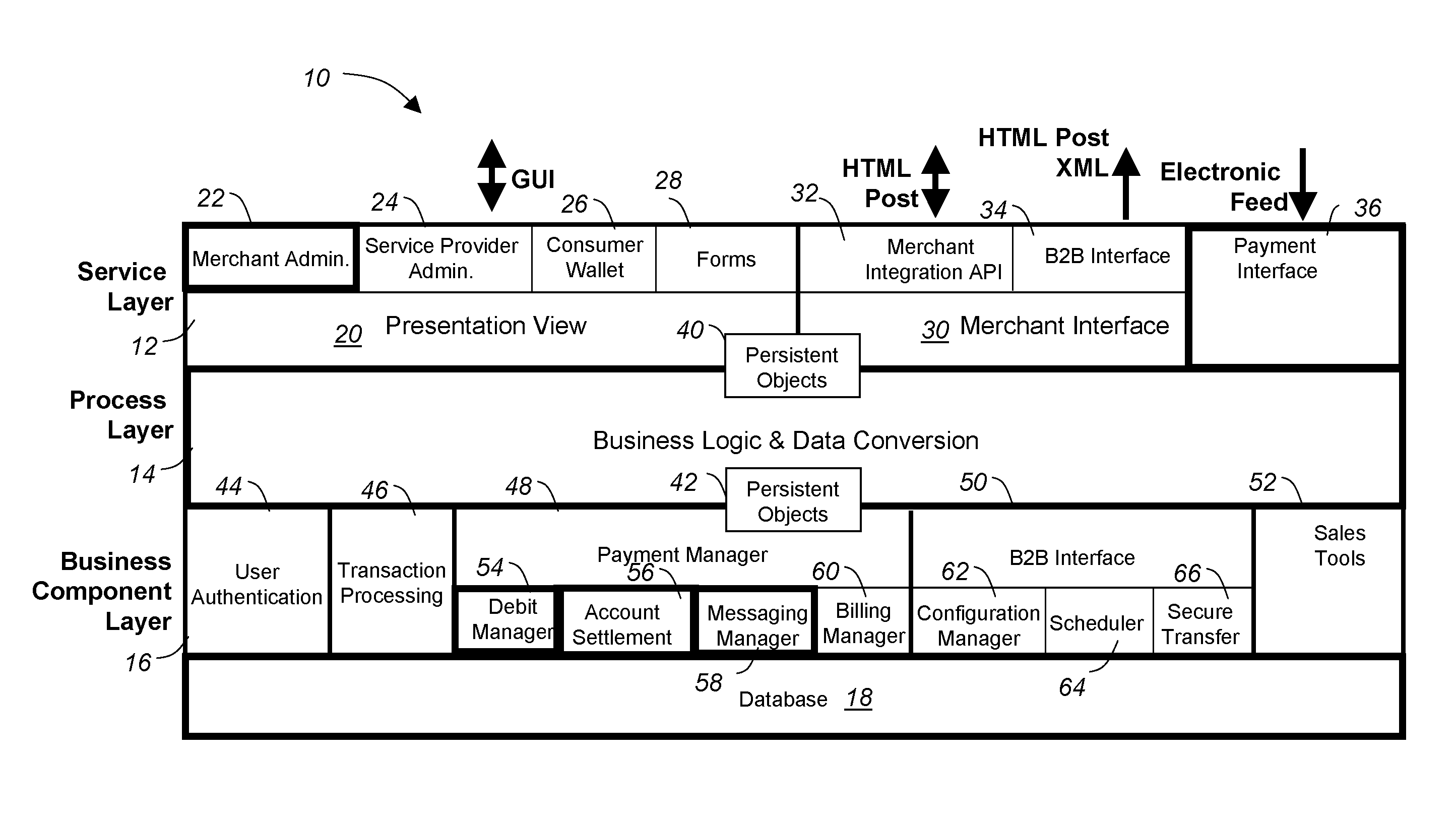

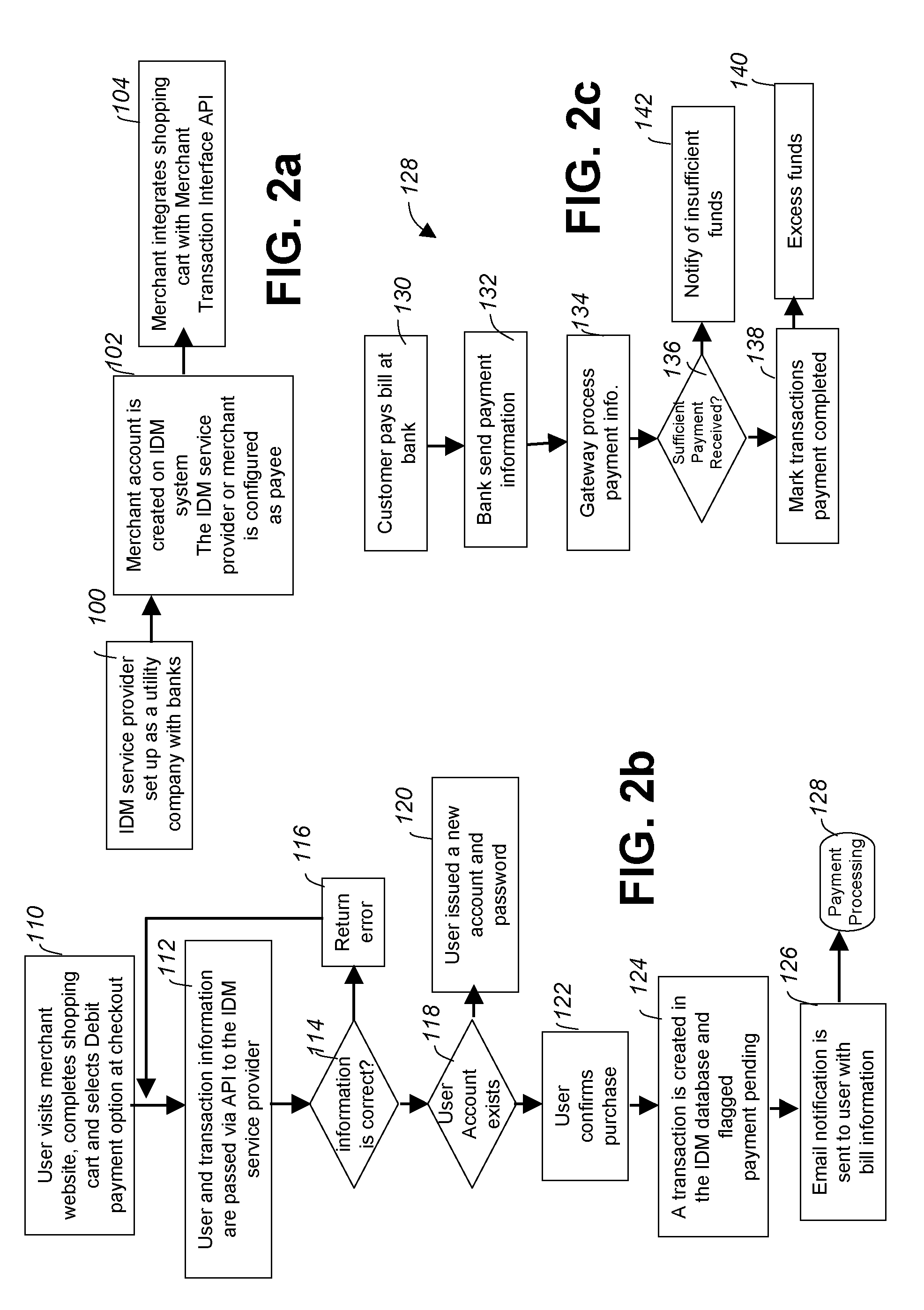

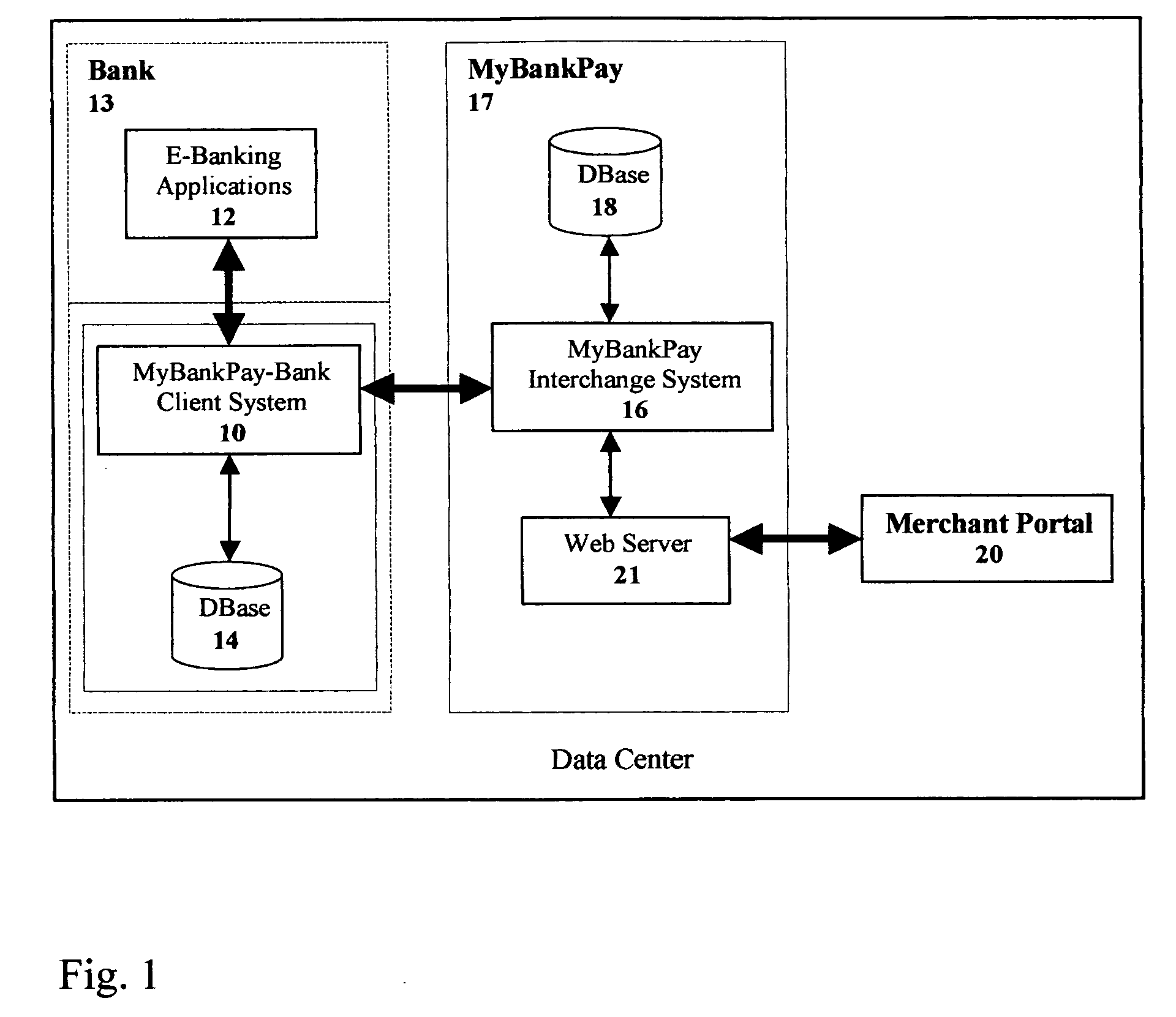

A system and method for facilitating payment for online purchases is disclosed. The system allows consumers / customers who shop online to select, at the time of checkout, direct payment from an account as the payment option. An electronic bill (ebill), independent of any confidential financial information pertaining to the consumer, is automatically displayed and emailed to the consumer. The consumer pays the ebill at their bank the same way they pay their utility bill, which then results in a payment confirmation sent from the bank to the payee. Payment information from the bank is sent to the system to update the purchase transactions. Once the payment information is processed, the consumer and merchant accounts are balanced and both receive automatic notification of the payment.

Owner:WESTERN UNION FINANCIAL SERVICES

Internet payment system and method

InactiveUS8566237B2Increase choiceLow costComplete banking machinesFinanceMerchant accountThe Internet

A system and method for facilitating payment for online purchases is disclosed. The system allows consumers / customers who shop online to select, at the time of checkout, direct payment from an account as the payment option. An electronic bill (ebill), independent of any confidential financial information pertaining to the consumer, is automatically displayed and emailed to the consumer. The consumer pays the ebill at their bank the same way they pay their utility bill, which then results in a payment confirmation sent from the bank to the payee. Payment information from the bank is sent to the system to update the purchase transactions. Once the payment information is processed, the consumer and merchant accounts are balanced and both receive automatic notification of the payment.

Owner:WESTERN UNION FINANCIAL SERVICES

Fraud-free payment for Internet purchases

InactiveUS20060218091A1Encourage e-commerceCost of setting up account is avoidedFinanceDebit schemesCredit cardBank account

A simple, non-intrusive, fraud free payment method for customers to make Internet purchases without using credit cards or revealing personal information. Customers can purchase any specific dollar amount of pay codes via on-line purchase by logging into their financial institution and purchasing the codes, via phone banking (using mobile phone or fixed telephone line) or via Automated Teller Machine (ATM). There is no need for the customer to first open an account with the payment service. The easy and fast set-up of a secure payment gateway for website merchants to receive payments for their goods purchased at their websites, eliminates the need of setting up a merchant account, chargeback and being penalized by banks for chargeback on sales. The amount due to the web merchant from the Internet transaction is credited directly into the merchant's bank account when the transaction and payment is approved by the customer's bank.

Owner:CHOY HENG KAH

Method and apparatus for ordering goods, services and content over an internetwork using a virtual payment account

A virtual payment card system for ordering and paying for goods, services and content over an internetwork is disclosed. The virtual payment card system comprises a commerce gateway component (52) and a credit processing server component (53). The virtual payment card system is a secure closed system comprising registered merchants and consumers. A consumer becomes a registered participant by applying for a virtual payment card. Likewise, a merchant becomes registered by applying for a merchant account. A consumer can instantly open an account on-line. That is, the credit processing component (53) immediately evaluates the consumer's virtual payment card application and assigns a credit limit to the account. Once an account is established, a digital certificate is stored on the registered participant's computer. The consumer can then order a product, i.e., goods, services or content from a merchant and charge it to the virtual payment card. When the product is shipped, the merchant notifies the commerce gateway component (52), which in turn notifies the credit processing server which applies the charges to the consumer's virtual card account. The consumer can settle the charges using a prepaid account, a credit card, or by using reward points earned through use of the virtual payment card. A consumer may create sub-account that have additional limitations imposed on the owner of the sub-account.

Owner:STRIPE INC

Systems and methods for additional notification and inputs of electronic transaction processing results

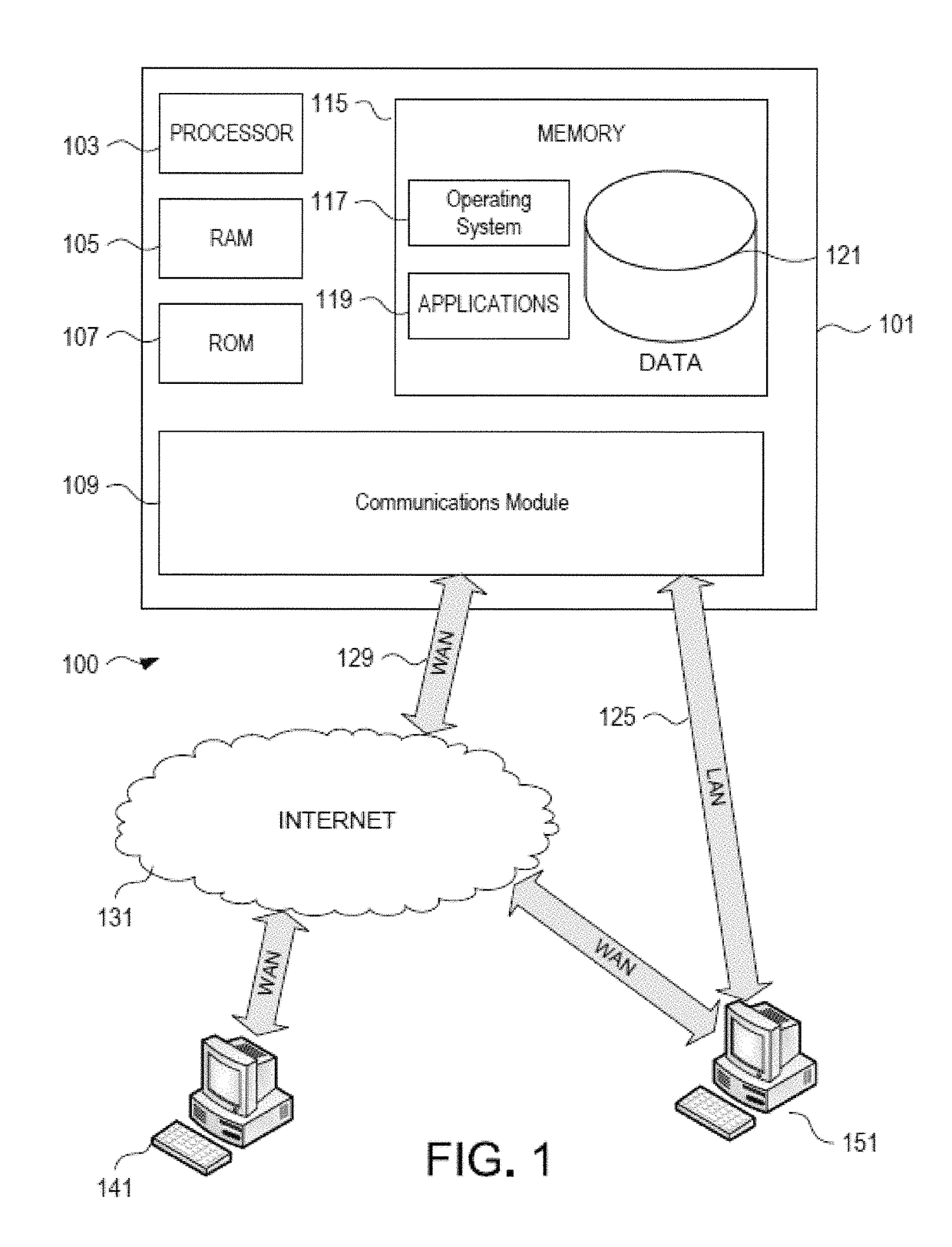

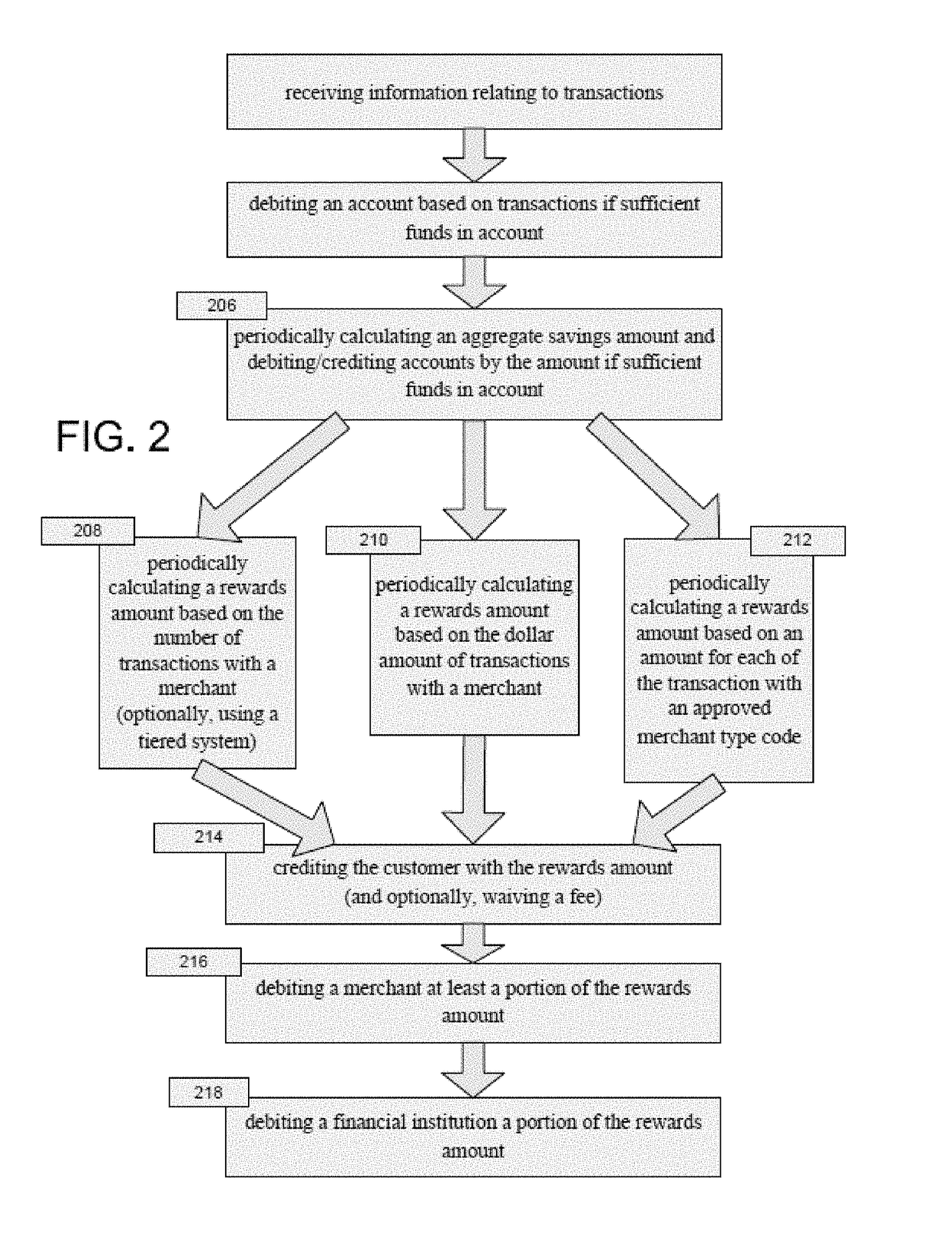

A computer implemented system and method are disclosed involving technological advancements in the processing of electronic transaction processing results. The system may comprise a computer apparatus implementing a checking account system, a savings account system, a merchant account and investment account on a funds management system, and one or more computer systems and mobile devices including a communication interface, processor, memory storing computer-executable instructions, and savings modules. Reward amounts may be calculated based on various techniques.

Owner:BANK OF AMERICA CORP

Payment system and method for use in an electronic commerce system

InactiveUS7146342B1Reduces transfer and processing costProtected from abuseComplete banking machinesFinanceClient agentMerchant account

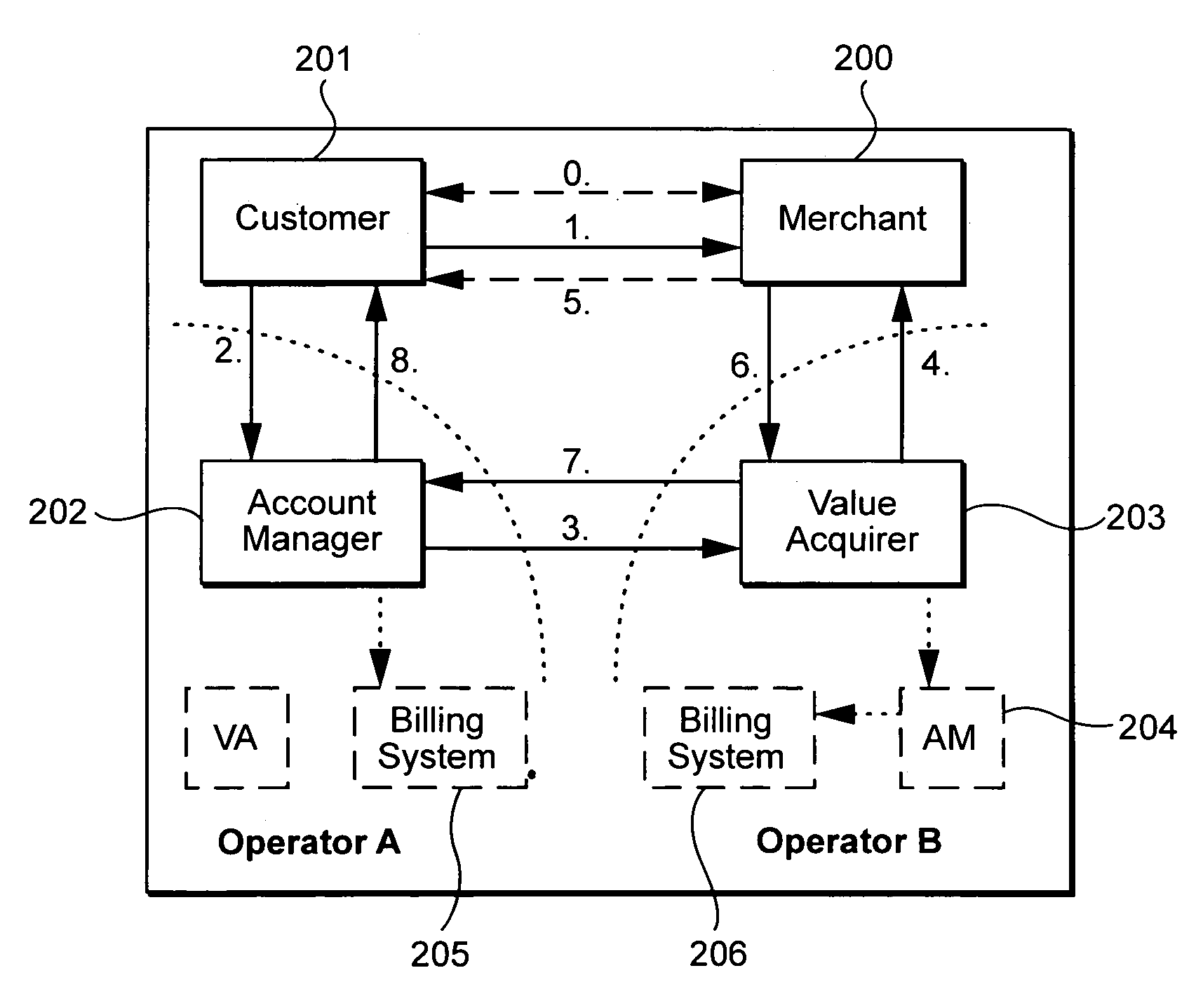

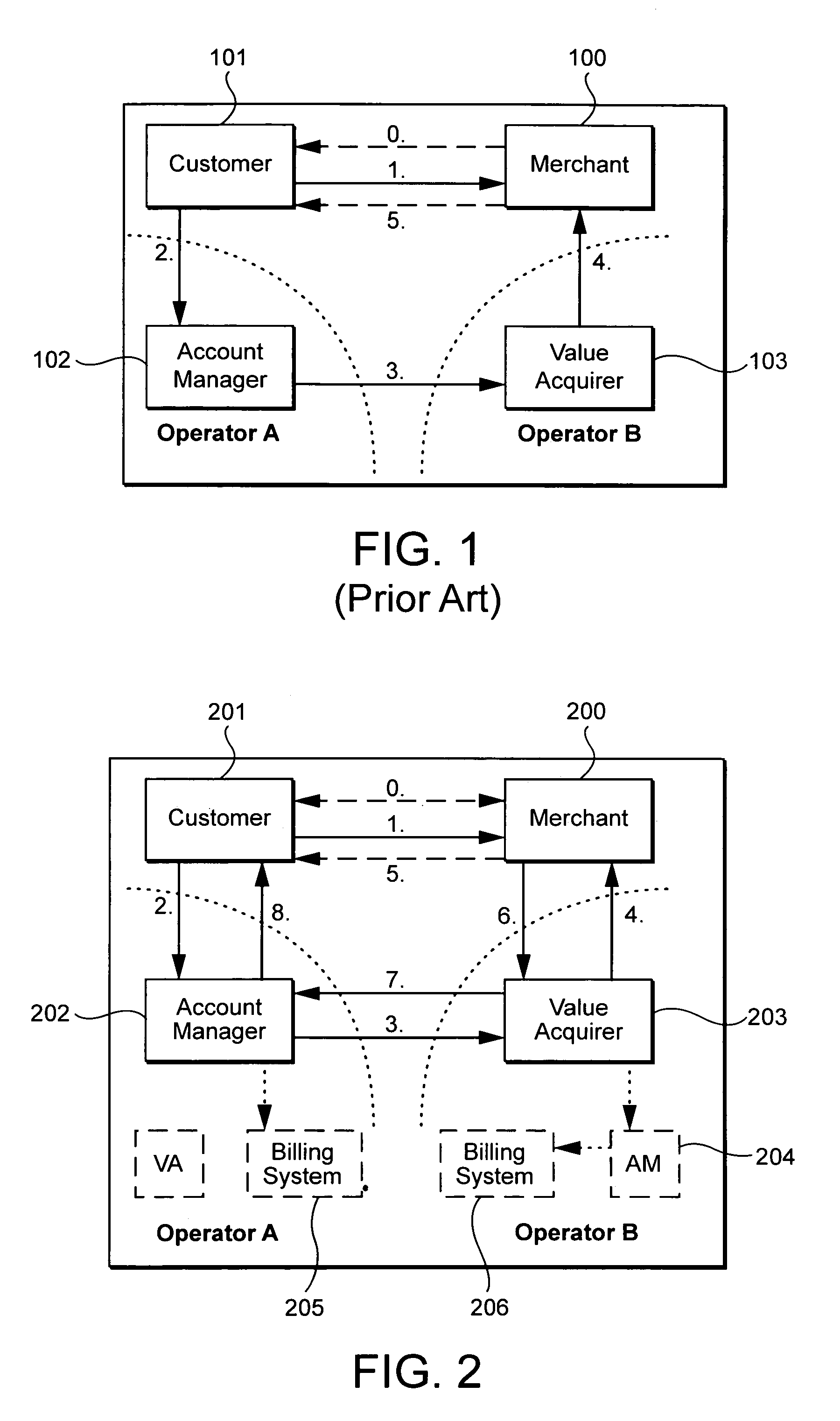

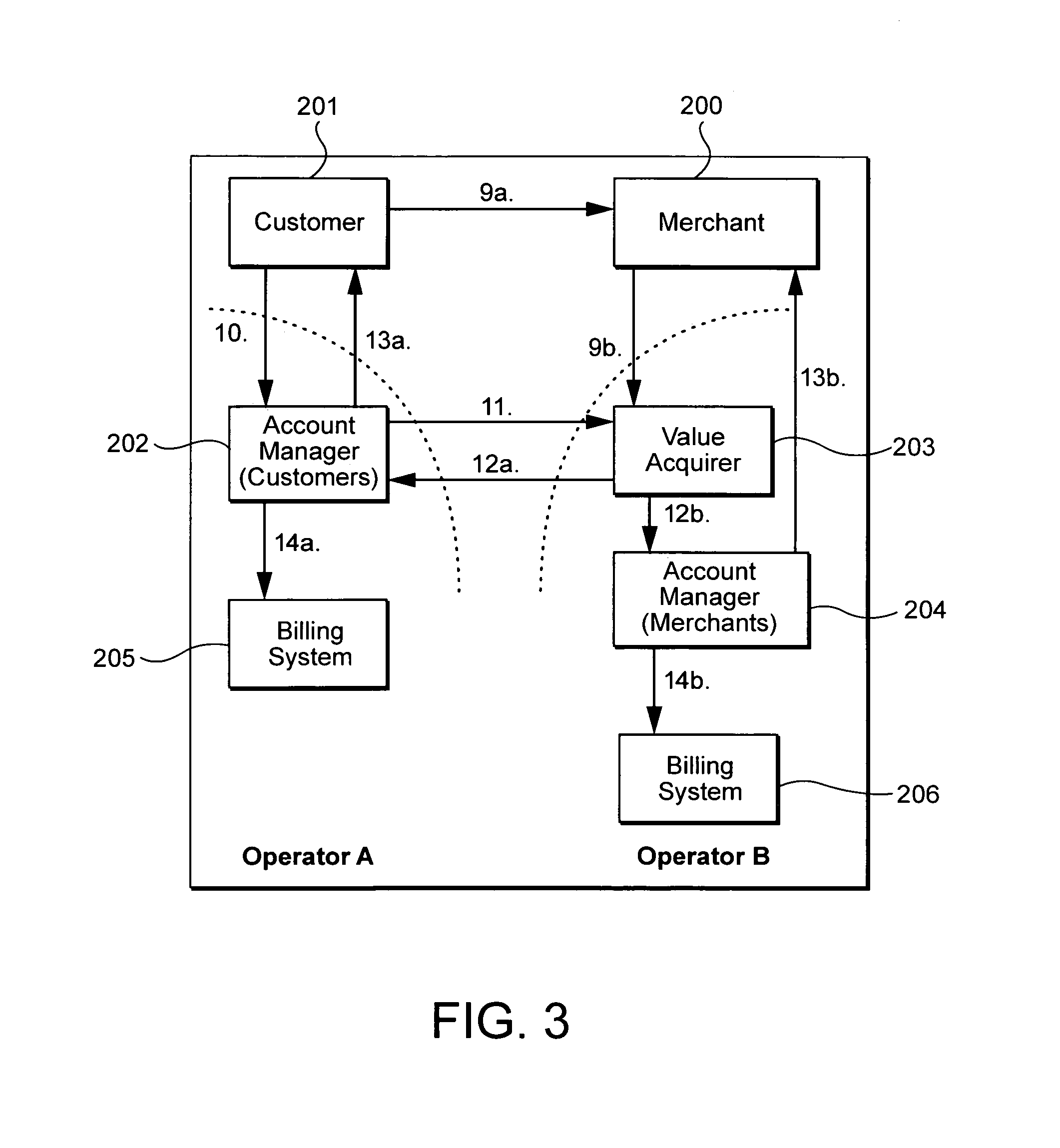

A method and system of payment of goods and services in an electronic commerce system reduces the transfer and processing costs for each purchase made by a customer from a merchant. A customer agent, a merchant agent, and account manager associated with the agents administer customer accounts and merchant accounts. A mediating trusted agent associated with one of the account managers and merchant agent transactions during a trading session. The customer agent and merchant agent, the account manager, and the mediating trusted agent are interconnected by an electronic communication network.

Owner:TELEFON AB LM ERICSSON (PUBL)

System and method for verification, authentication, and notification of transactions

InactiveUS20110016050A1Facilitate communicationIncrease likelihoodFinanceBuying/selling/leasing transactionsTelecommunications linkShort Message Service

A system and method for verifying, authenticating, and providing notification of a transaction, such as a commercial or financial transaction, with and / or to at least one party identified as engaging in the transaction and / or identified as having a potential interest in the transaction or type of transaction, are provided. A central system accepts information regarding a transaction, including information about at least one party identified as engaging in the transaction, such as by a credit account number or Social Security number or merchant account number, and / or identified as having a potential interest in the transaction. Based on the information regarding the transaction and any supplemental information the central system determines, the central system communicates with and / or to at least one party and / or additional or alternative parties, via at least one communications device or system having a communications address, such as a telephone number or Short Message Service address, predetermined as belonging to the at least one party and / or additional or alternative parties. Via said communications, at least one party having an interest or a potential interest in the transaction may be notified of it, and may further be enabled or required to supply additional verifying or authenticating information to the central system. If the transaction was initiated or engaged in via a communications link, such as via the Internet, said communications preferably occur over at least one different communications link and / or protocol, such as via a wireless voice network. The central system may then compute a result based on the outcomes of said communications, and may then transmit the result to the user and / or to a second system or device.

Owner:EVANS ALEXANDER WILLIAM

Mobile personal point-of-sale terminal

InactiveUS20160275478A1Acutation objectsPoint-of-sale network systemsMerchant accountFinancial transaction

Owner:MAXIM INTEGRATED PROD INC

System and methods for a multi-channel payment platform

The platform executes secure payment transactions between customers and registered merchants by using remote terminals. When the user authorizes his / her payment data (e.g. using a credit card) to be permanently stored in the central system, it is possible to extend payment functionality to other remote devices (e.g. a mobile phone, a cable-TV, a touch-tone telephone . . . etc). By remotely placing the payment functionality on the central system, payment data are never managed by the merchant or by the user. The system comprises a central computer information system and a number of remote terminals used for executing payment requests. When receiving a payment request, the platform recognizes the user, retrieves from its database his method of payment, the merchant account number and conducts the real payment transaction interacting with external financial institutions.

Owner:PILO BRUNO

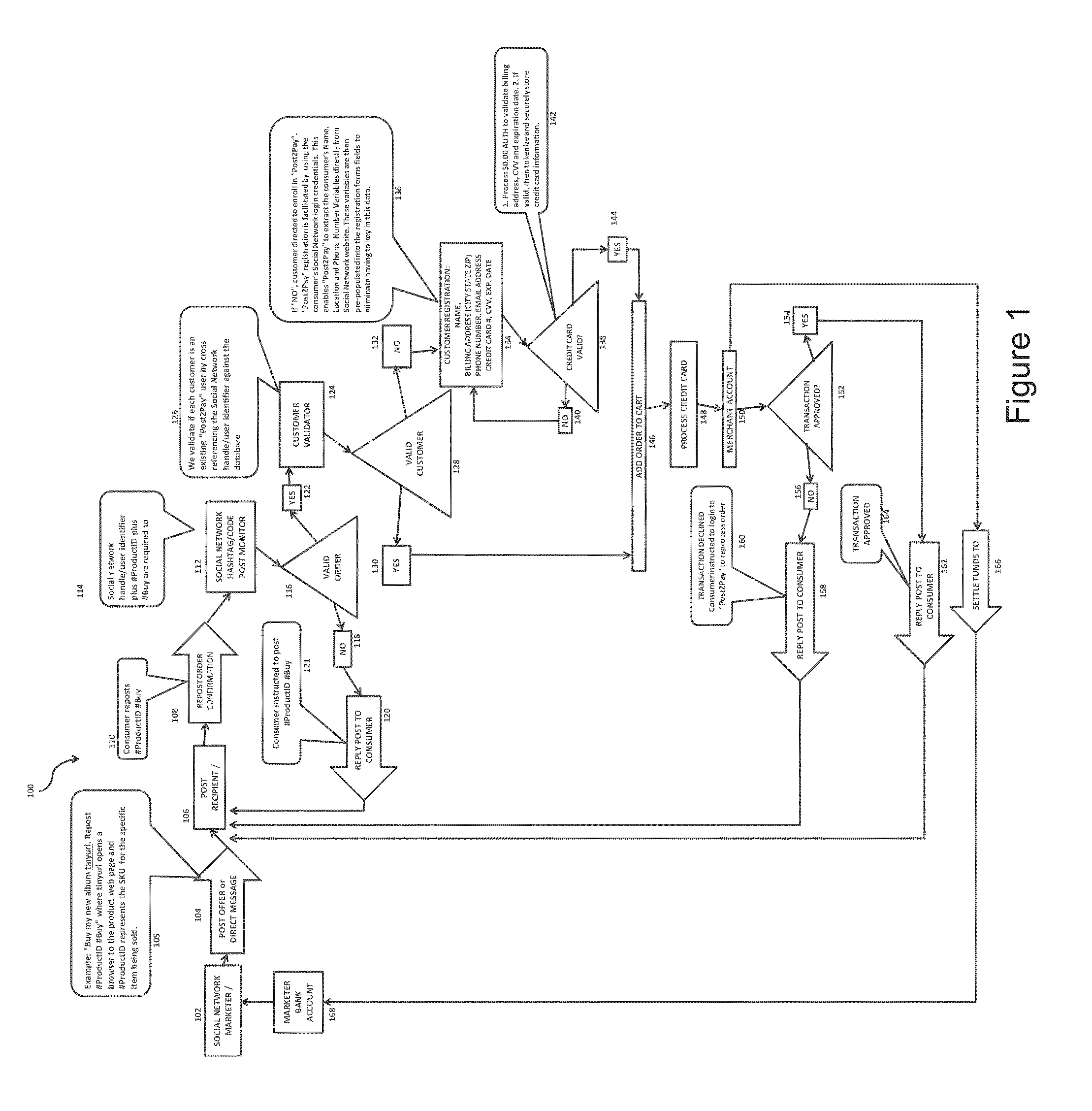

System and method for purchasing by social network status update or post

InactiveUS20150088650A1Simple and yet elegantQuickly purchasingDigital data information retrievalBuying/selling/leasing transactionsPaymentMerchant account

A system and method facilitating online purchases within social network environments comprises posting or re-posting a string of characters affiliated with a product on a social network newsfeed, page, or as a status update. The system includes a search engine monitoring posts for the string of characters indicating intention to purchase and a payment processing component. The purchase is completed without further entry of information by the user if the user's financial data is previously available. The system may include a customer validator, payment information validator, electronic receipt generator, error detection components, and may communicate with an external merchant account. The method allows an internet merchant or marketer to offer a product for sale by posting a string of characters that can be purchased by users of a common social networking platform by posting or re-posting the string of characters.

Owner:TAYLOR THOMAS JASON +1

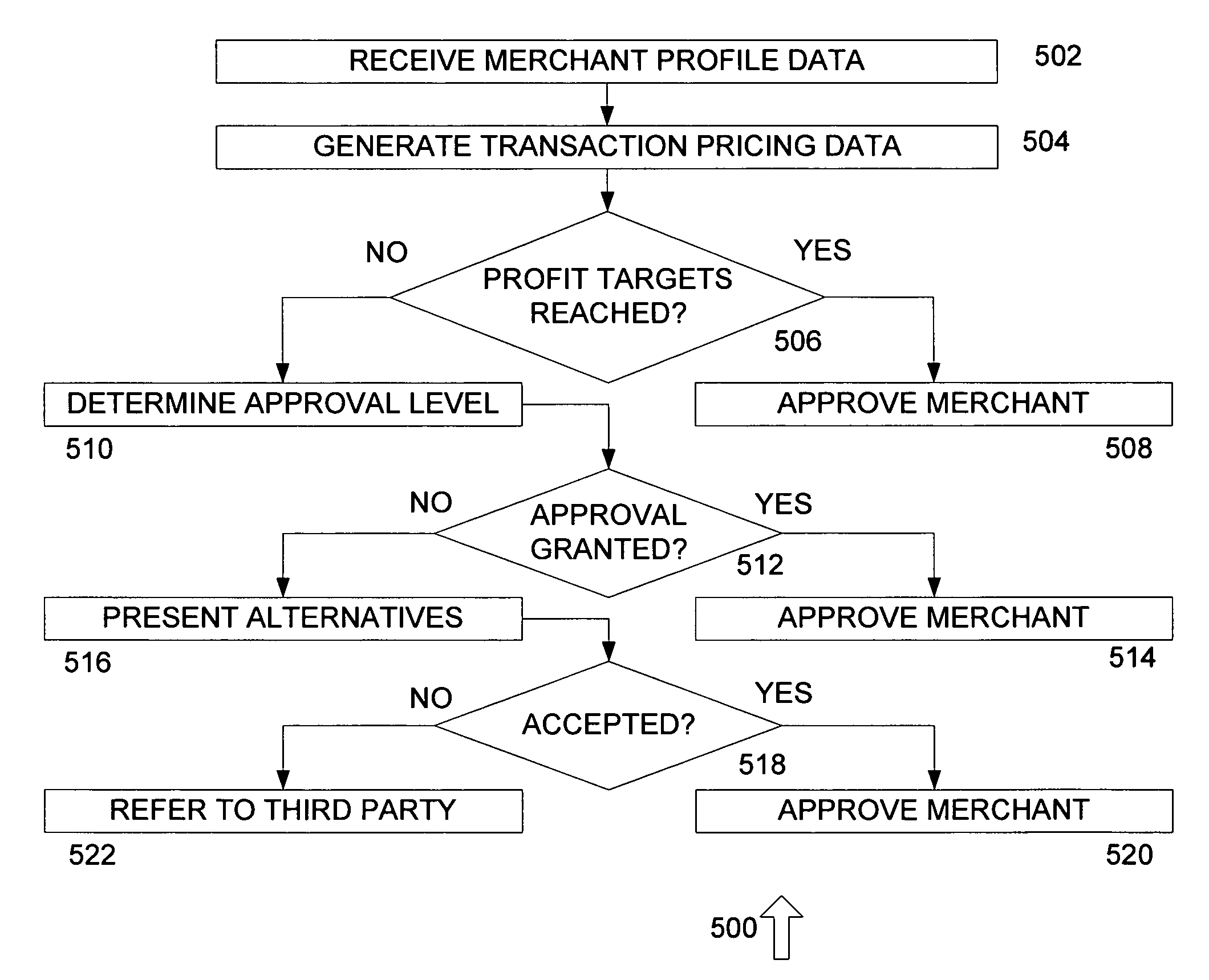

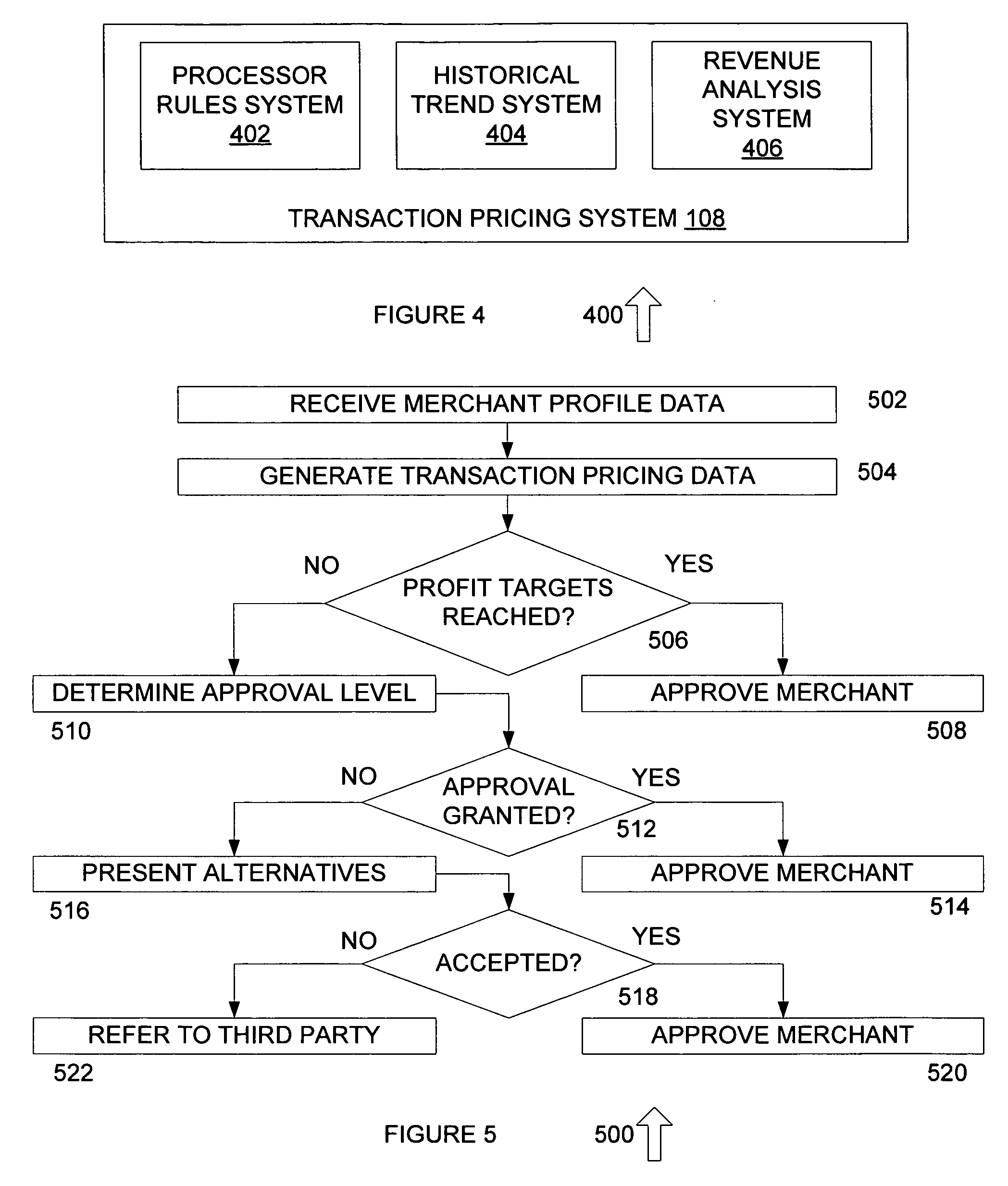

System and method for pricing of merchant accounts

A system for managing merchant payment transaction processing accounts is provided. The system includes a merchant initialization system that receives merchant account data from a user, such as to provide a quote to the merchant for payment processing. A transaction pricing system receives the merchant account data and provides transaction pricing data for payment transaction processing in response to the merchant account information. User access to one or more merchant account pricing algorithms that are used generate the merchant account pricing data in response to the merchant account data is restricted to a predetermined set of users, so as to prevent unauthorized users from obtaining access to the merchant account pricing algorithms.

Owner:PAYMENTECH INC

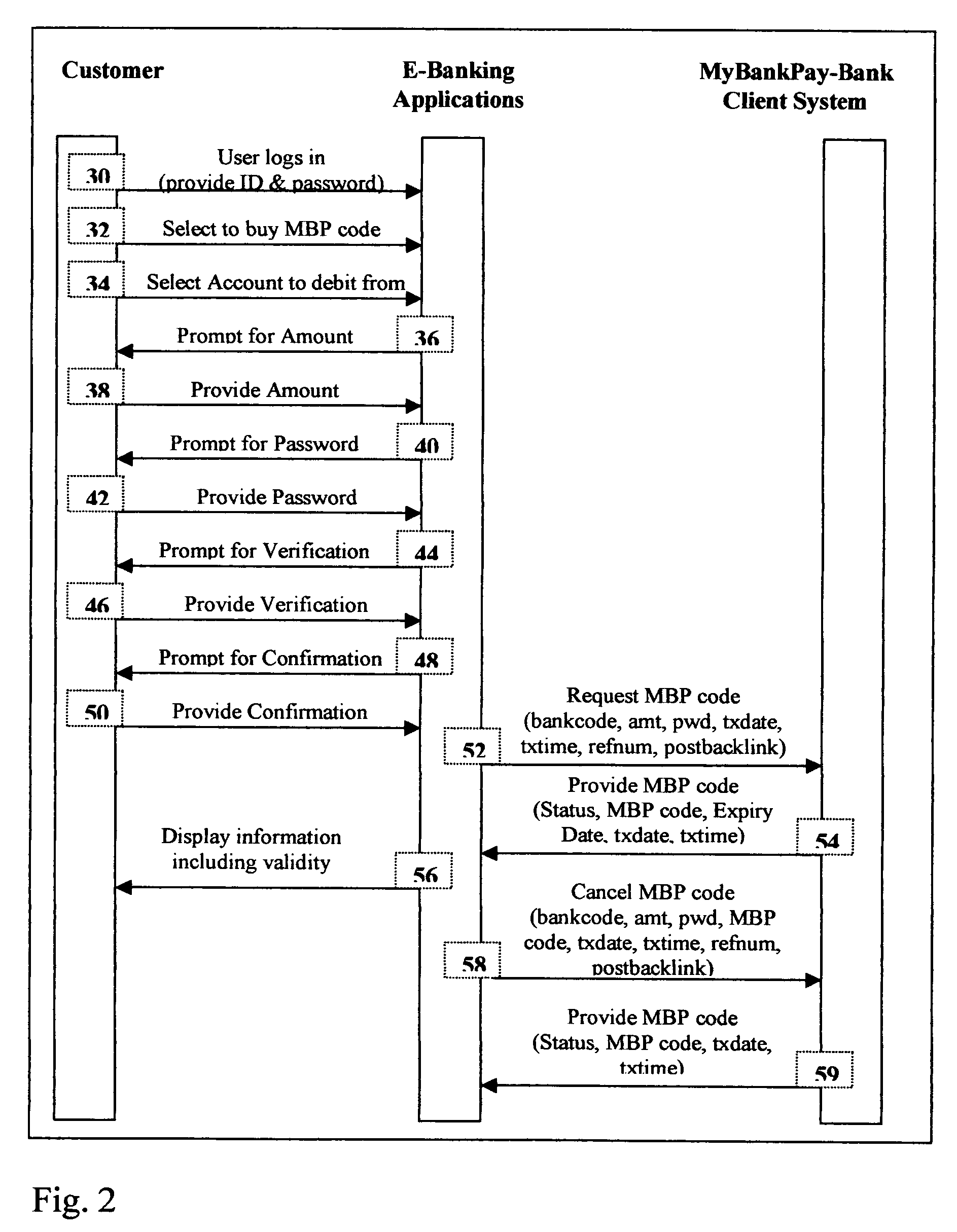

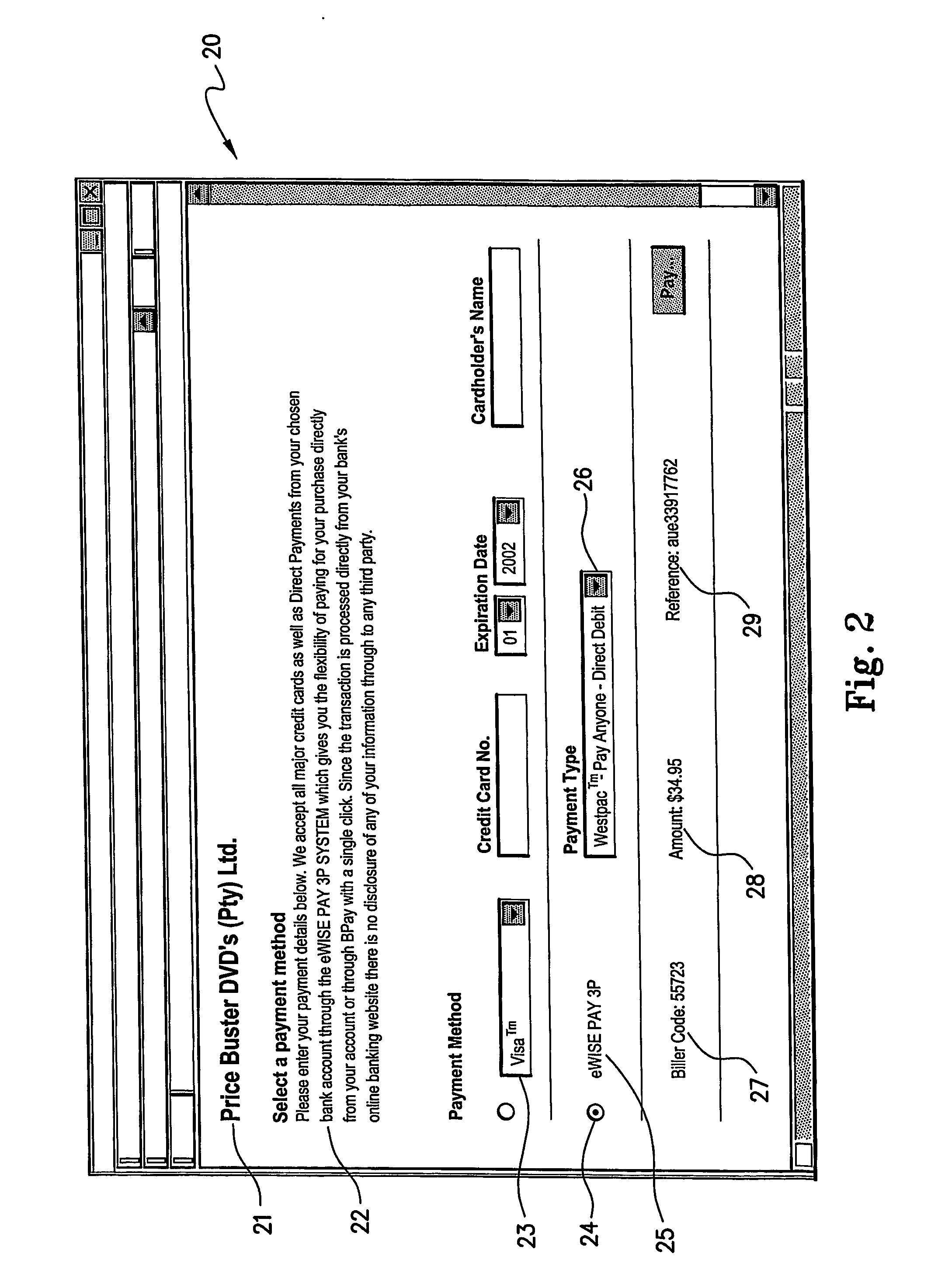

System and method for facilitating on-line payment

ActiveUS20070100770A1Avoids fraudulent generationReduce chanceDebit schemesSecret communicationWeb siteCredit card

The present invention relates to a system and method for facilitating on-line payment particularly for goods or services purchased via a merchant site on the Internet. The system enables payment from an existing customer account at a financial institution, but does not require the user to provide credit card details. The payment is implemented in real-time from the customer account to a merchant account via a financial institution application such as an Internet banking website. An interface is provided which is initiated via the merchant site and which then interfaces the customer computer to the financial application having access to the customer computer's account. The customer can then enter payment details directly with the financial institution to pay the merchant directly for the transaction.

Owner:PAYWITHMYBANK

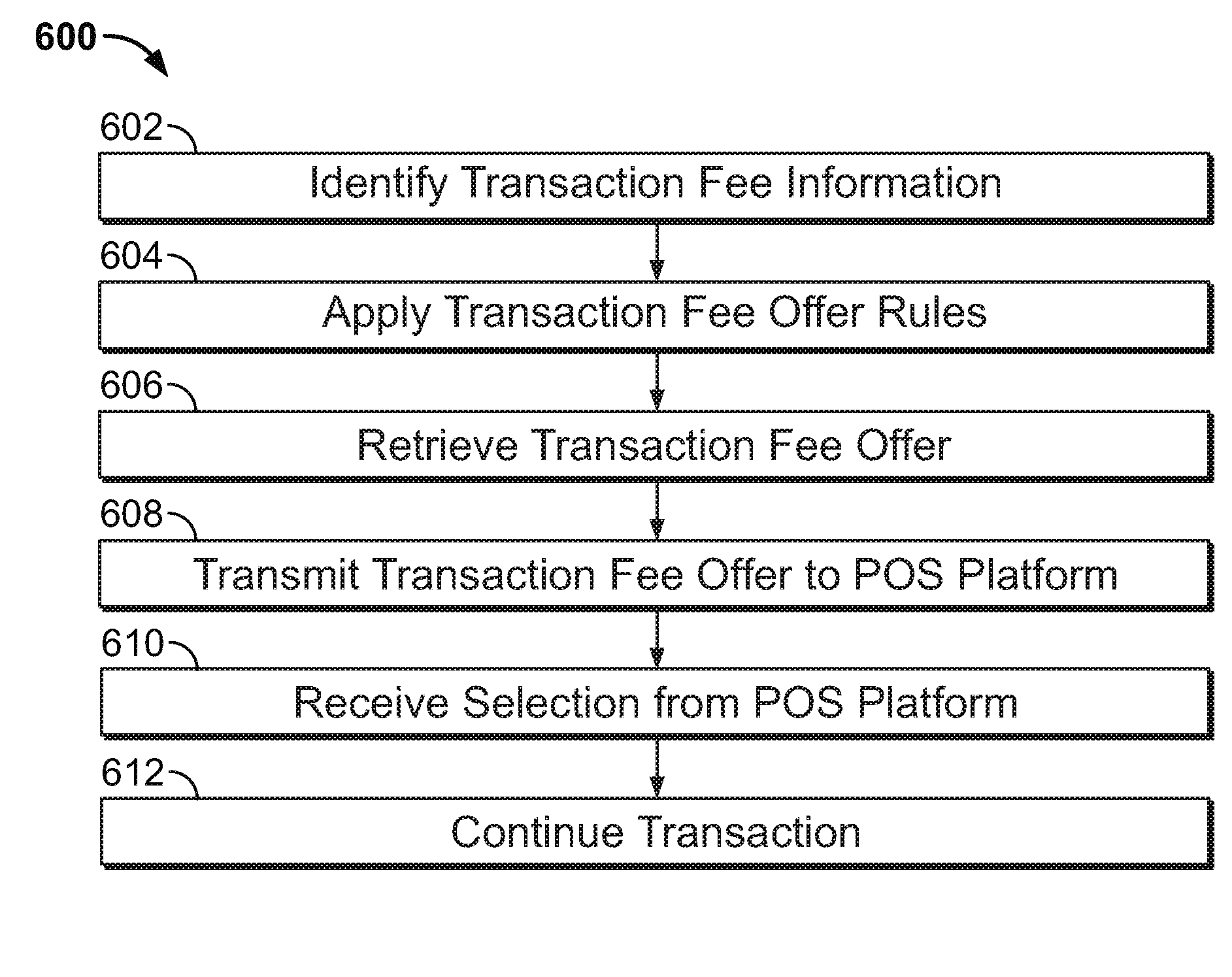

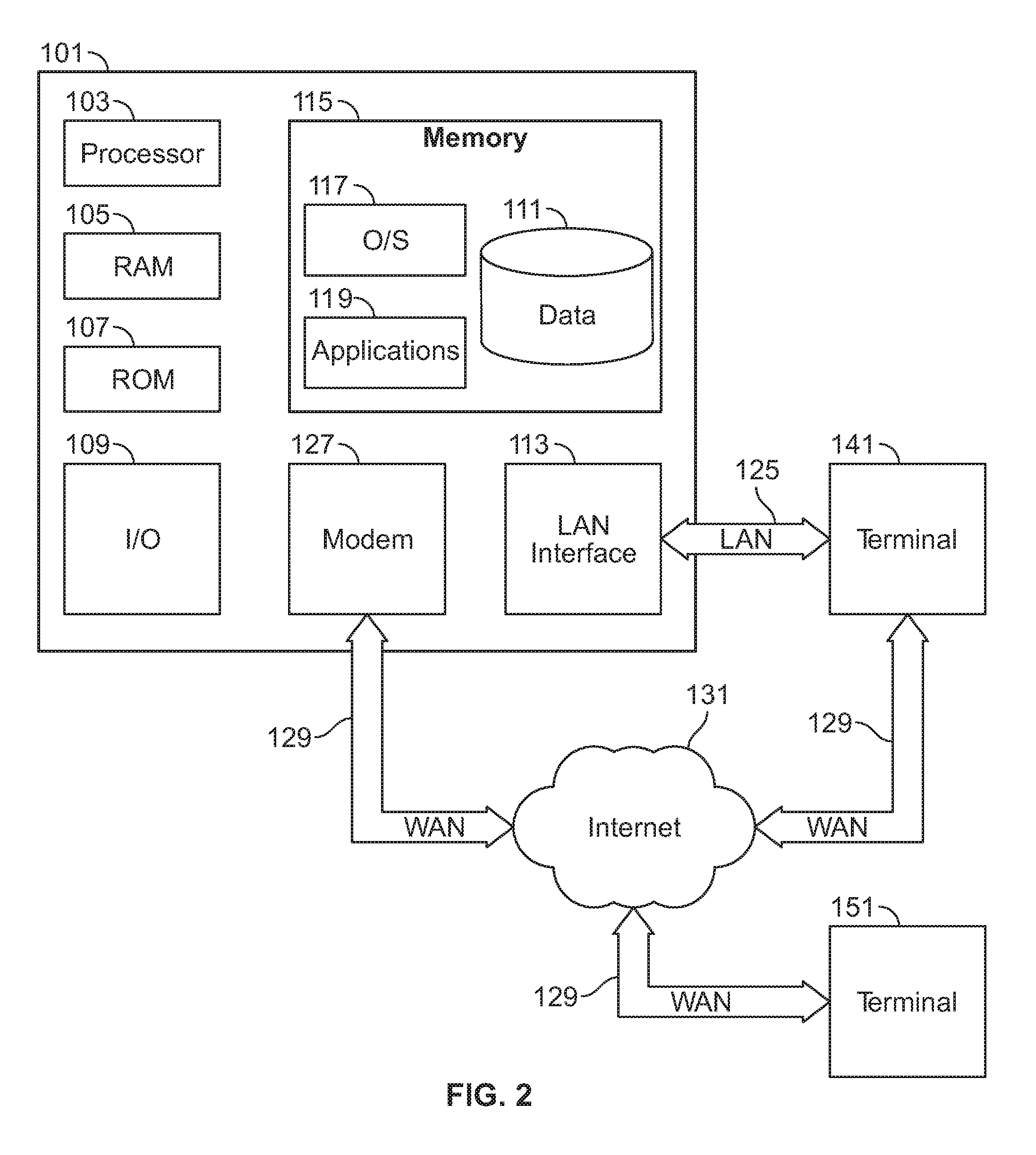

Interactive interchange rate decisioning

Apparatus and methods for providing transaction fee information to a customer. The apparatus and methods may provide to a customer at a merchant point of sale terminal information regarding a transaction fee. The transaction may be based on the customer's credit card or other purchasing instrument. The transaction fee may be imposed by an issuer of the credit card. The merchant may be required to pay the fee. The point of sale terminal may be configured to provide an opportunity for the customer to decide, based on the transaction fee, whether to continue the transaction or obtain information about fees associated with other credit cards.

Owner:BANK OF AMERICA CORP

Linking a merchant account with a financial card

ActiveUS7856399B2Reduce riskPerformance requirementFinanceCoded identity card or credit card actuationPaymentMerchant account

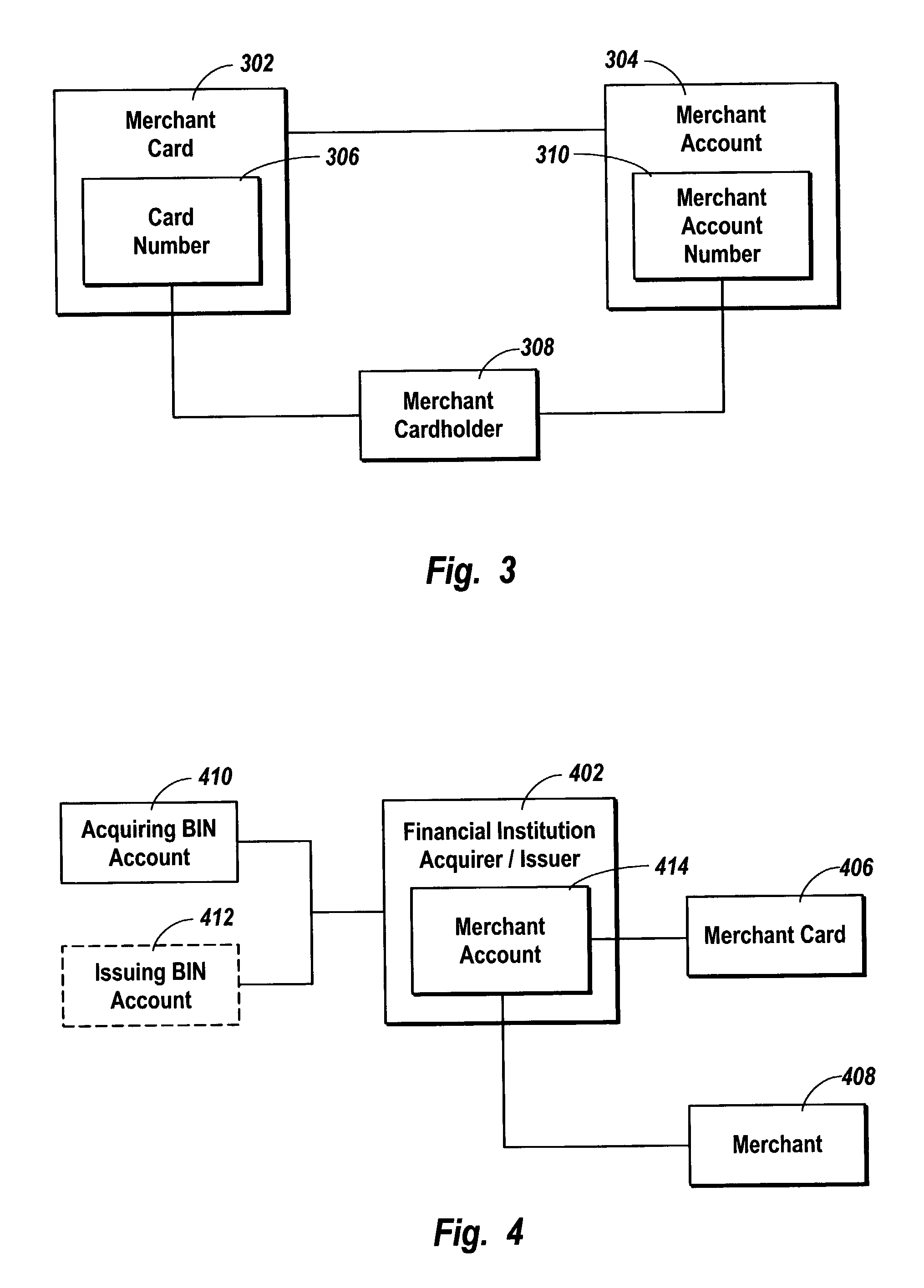

Systems and methods for linking a merchant card with a merchant account. A financial institution that issues the merchant card to a merchant acts as both issuer and acquirer for the merchant. The merchant uses the merchant card to accept other financial cards as payment. Funds due the merchant are added to an available balance of the merchant card rather than depositing the funds in a settlement account. The funds can be added to the available balance before the transactions settle and can be accessed by the merchant. The financial institution also authorizes transactions when the merchant uses the merchant card as a regular cardholder to make payment. The merchant name can be changed on a per transaction basis if desired.

Owner:PROPAY USA

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com