Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

86 results about "Financial application" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A financial application is a software program that facilitates the management of business processes that deal with money. Types of finance applications include: accounts payable software - allows a business to stay on top of outstanding payments and make sure all payments are made correctly and on time.

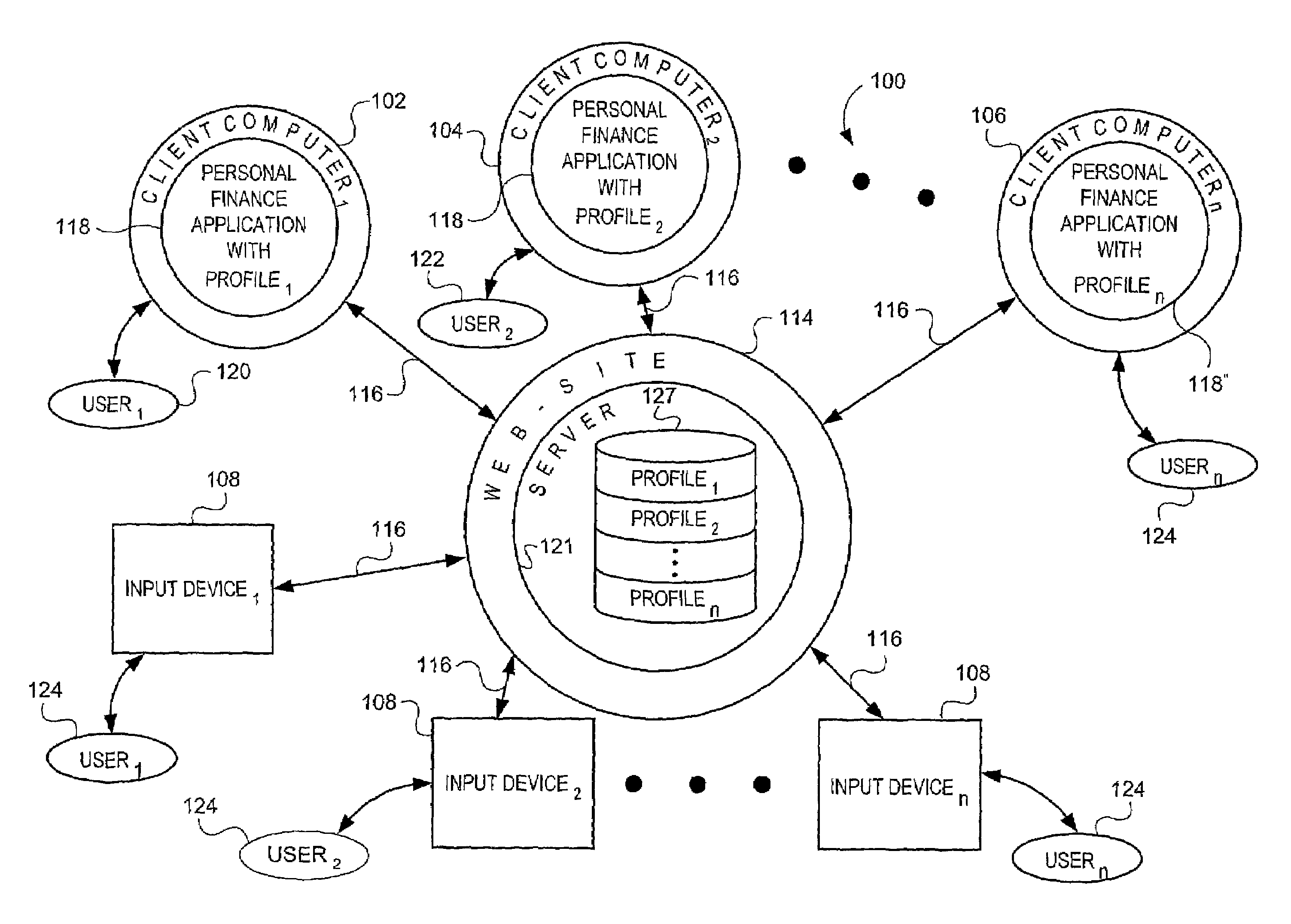

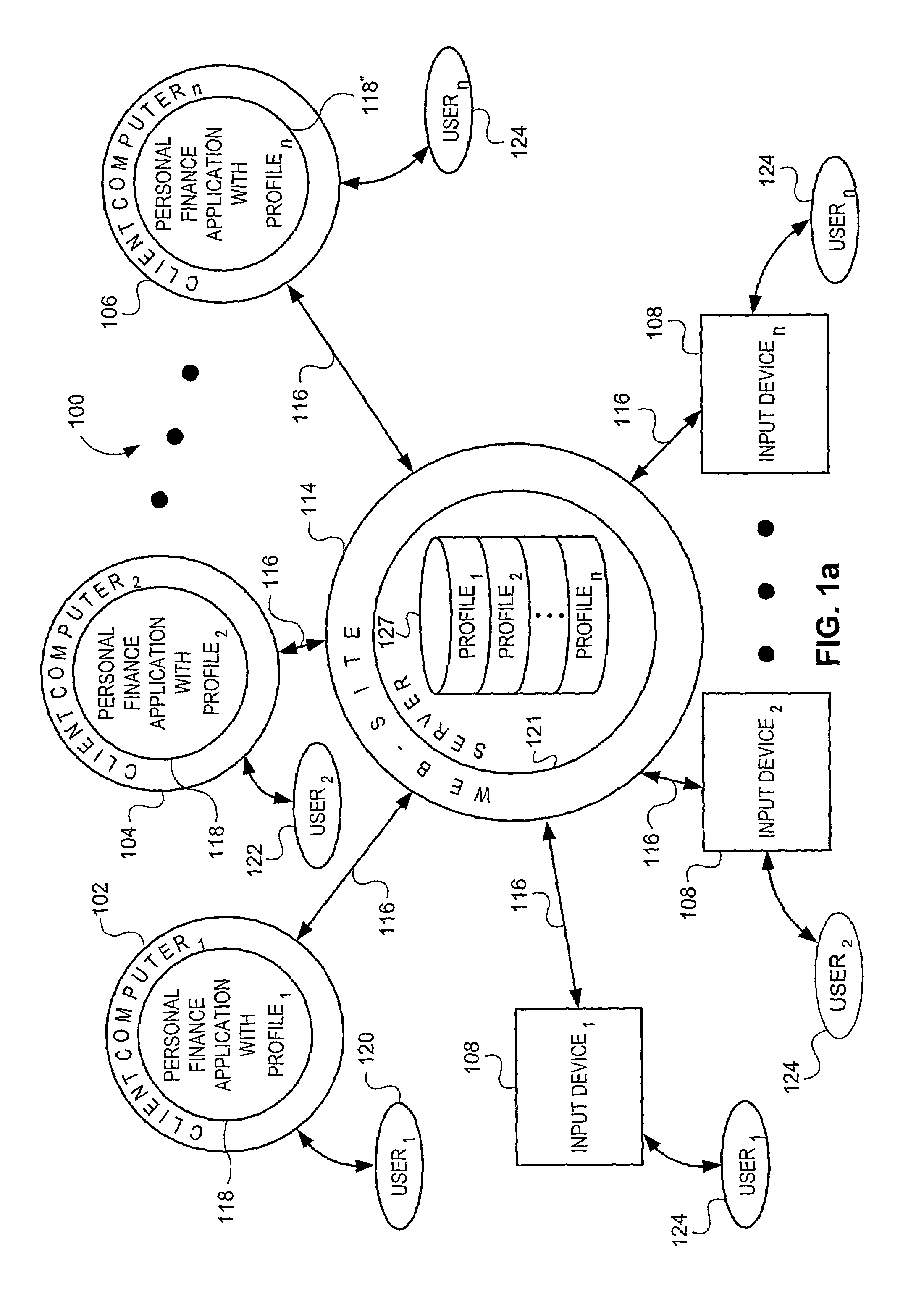

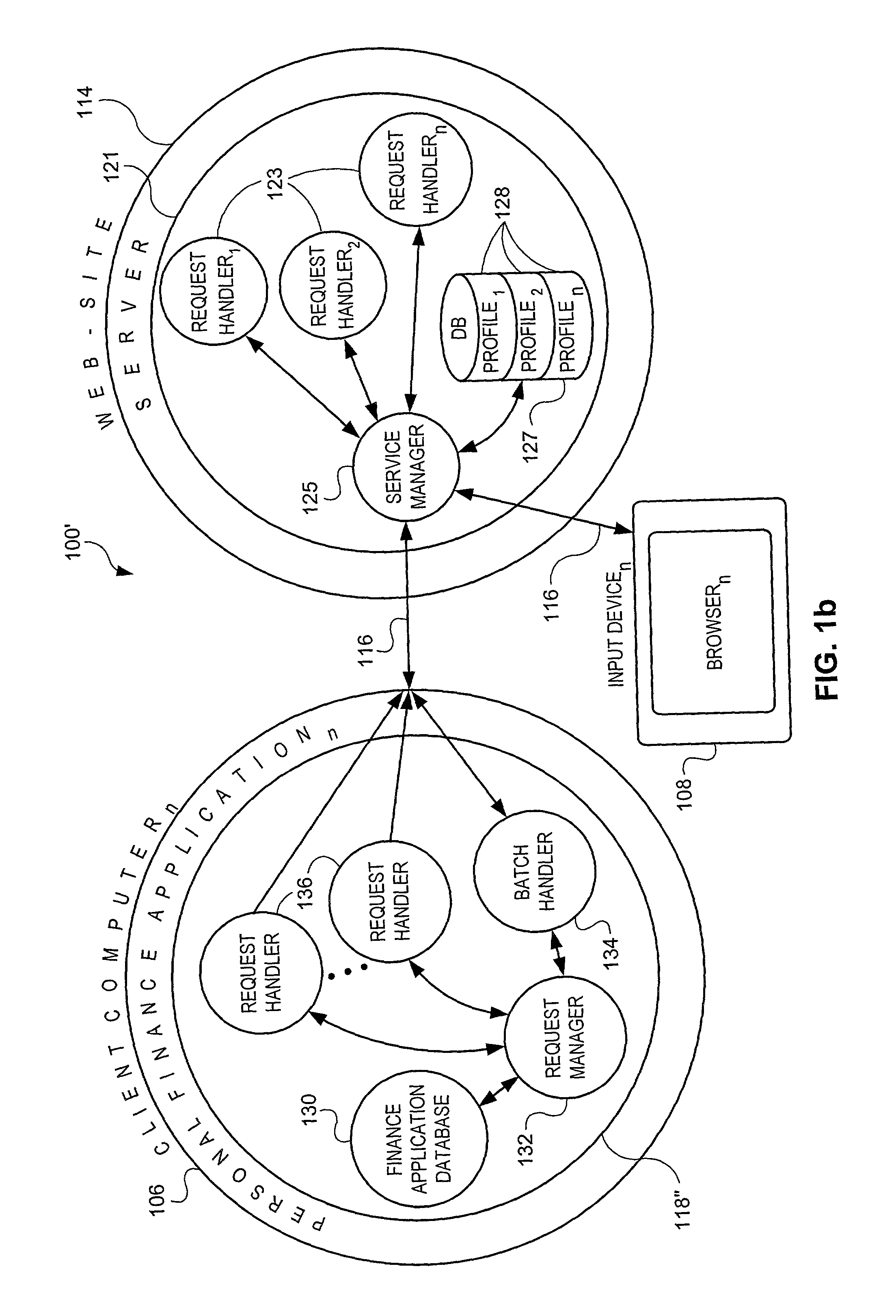

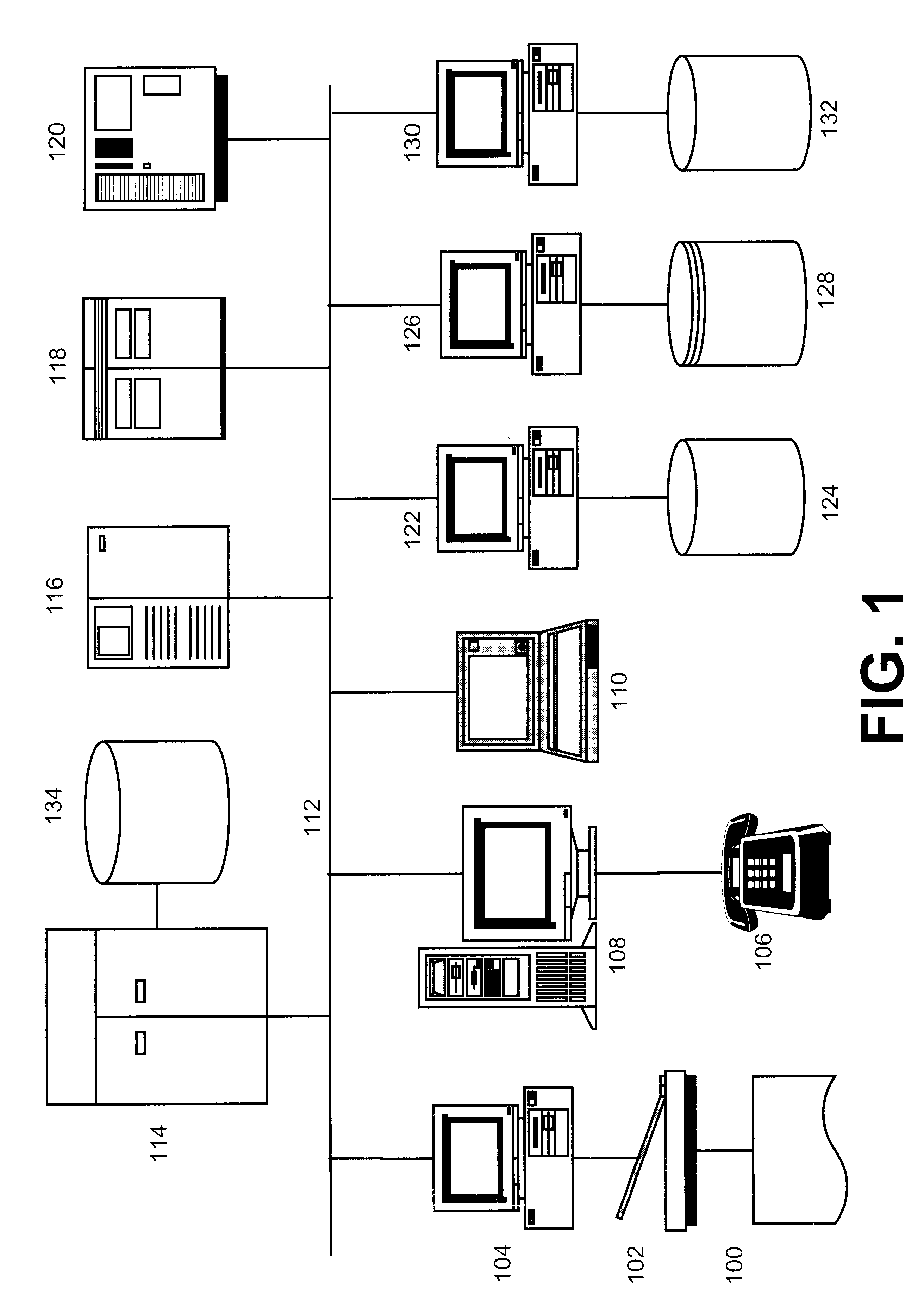

Web-based entry of financial transaction information and subsequent download of such information

InactiveUS7729959B1Reduce probabilityImprove timelinessComplete banking machinesFinanceWeb siteFinancial transaction

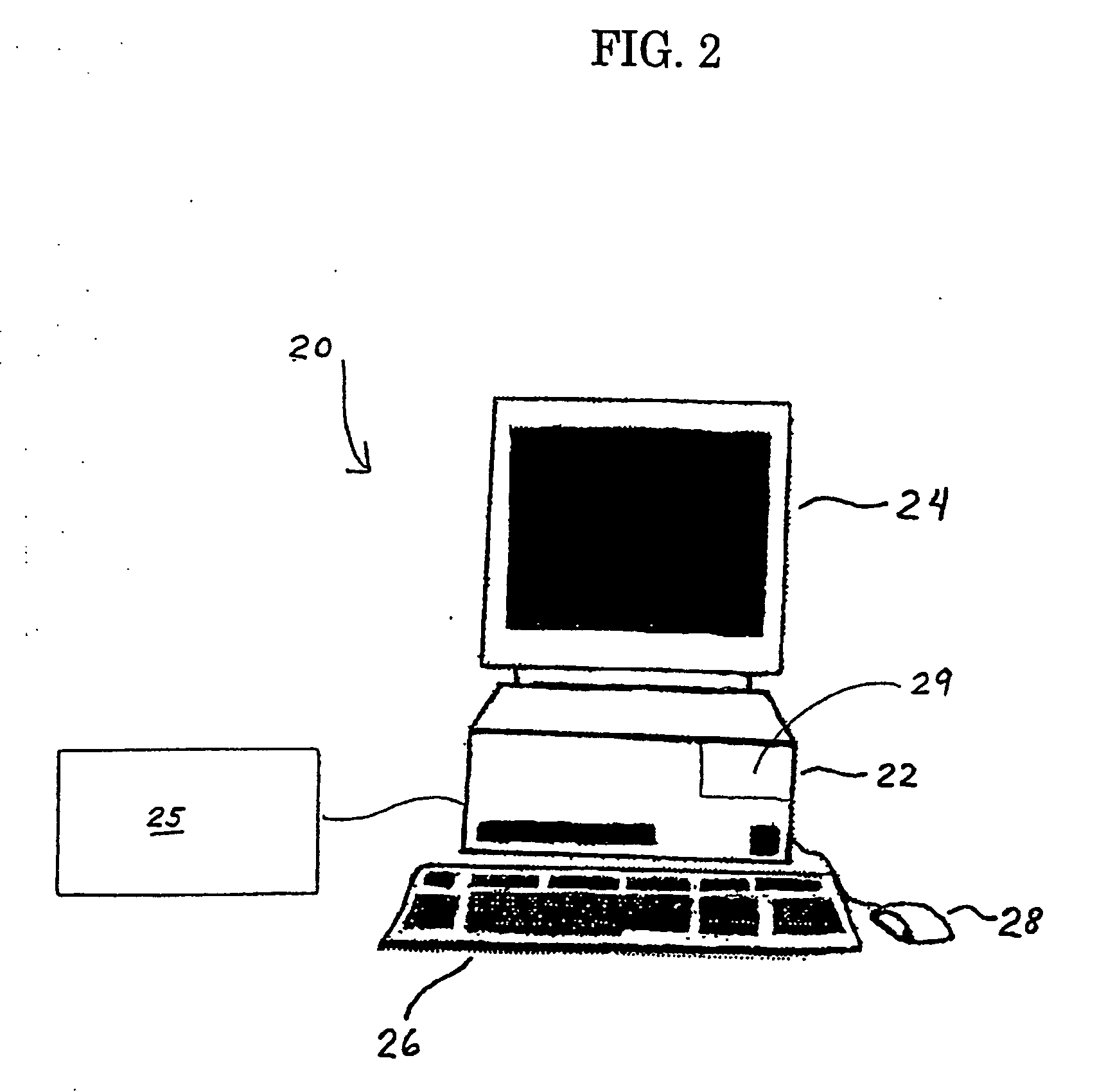

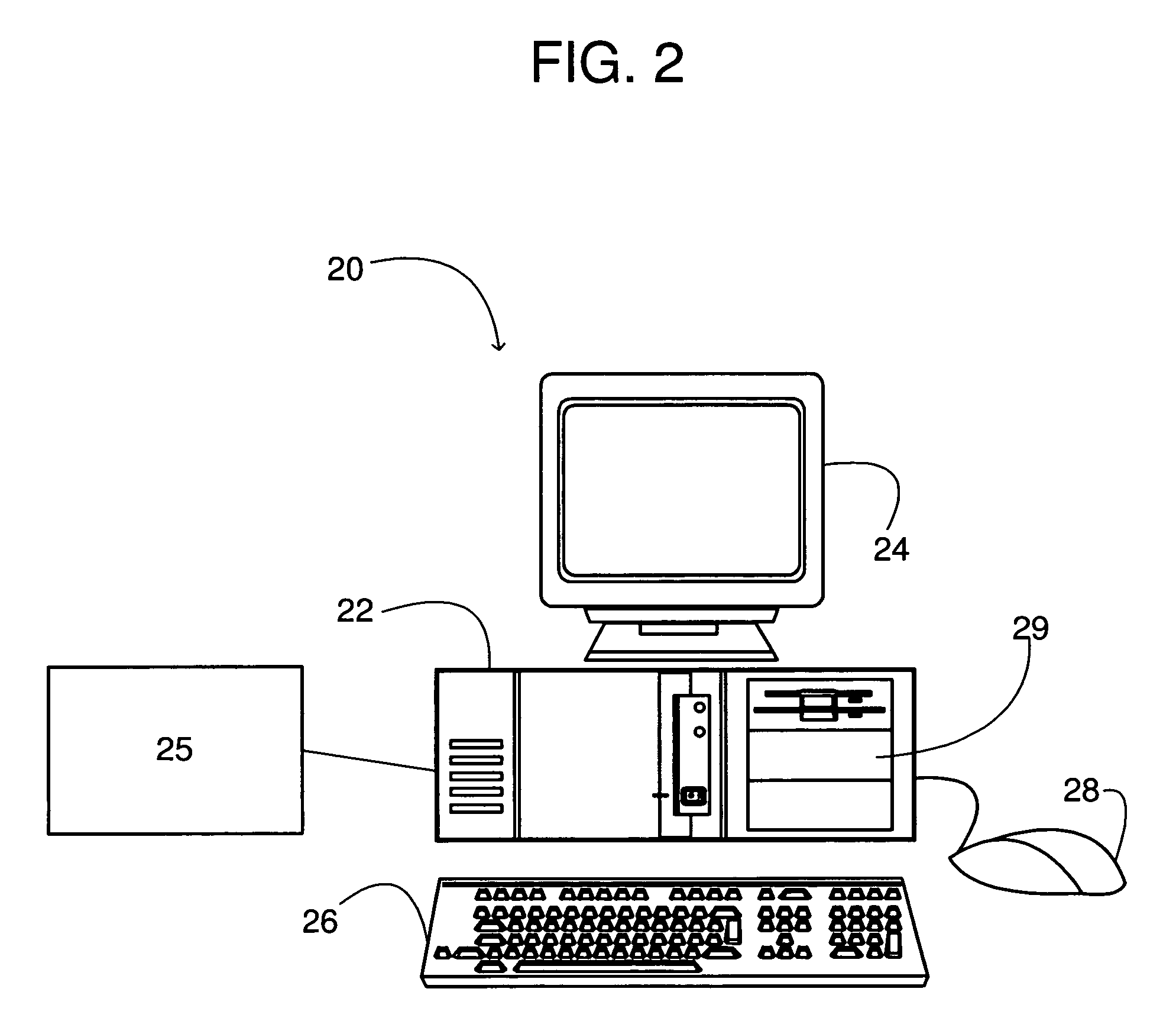

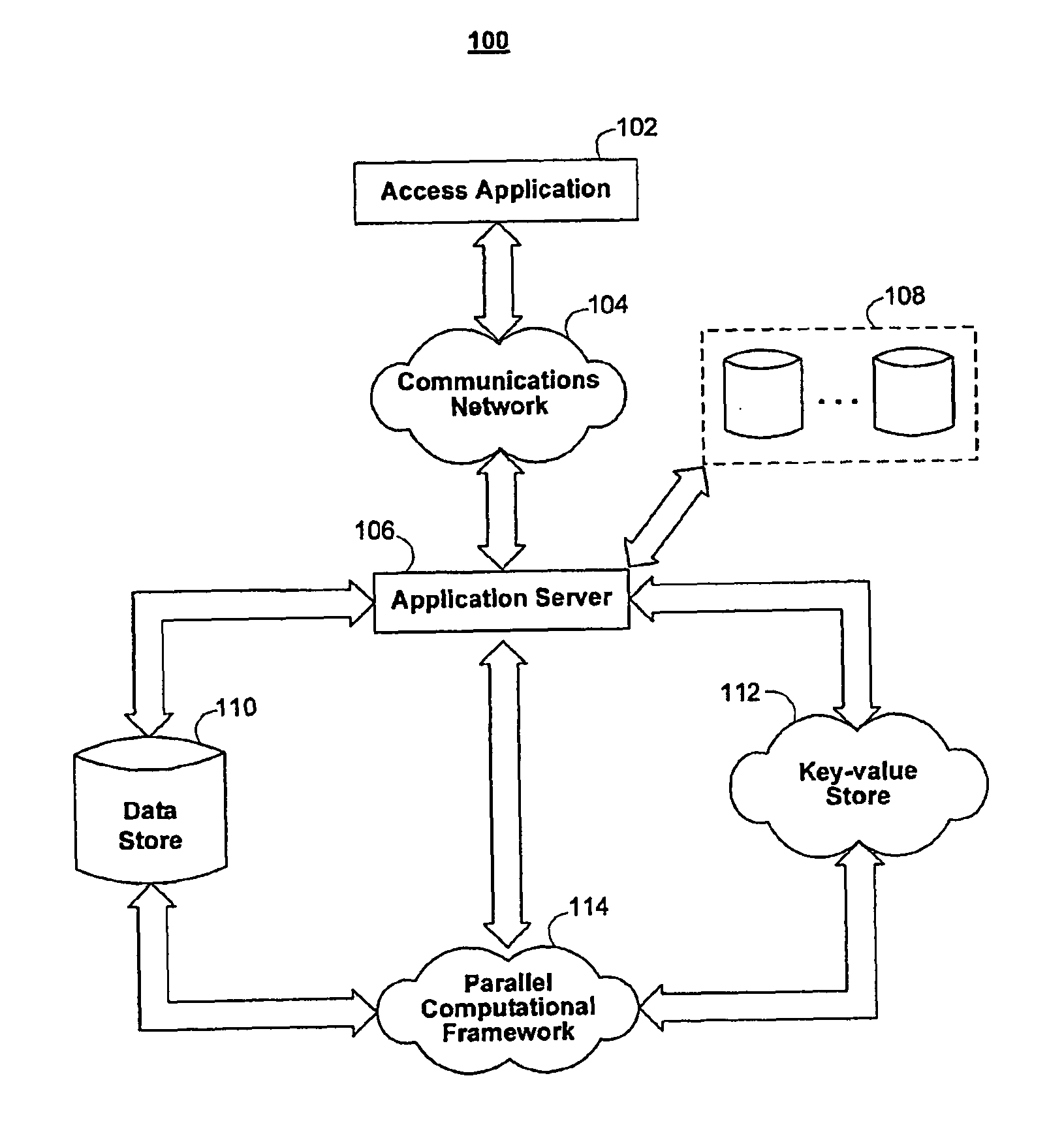

The systems, methods and related software products which enable users to temporarily store and subsequently retrieve information are disclosed. The system includes a plurality of input devices, client computers (each having a user-specific personal finance application) and a web-site server with a database. The input devices, client computers and server are communicatively linked via a communication network so that a plurality of users can temporarily store and / or manipulate financial transaction information on the server from any of the input devices. Each user can also transmit financial profile information to the server. This information enables the server to replicate the unique profile characteristics for each of the finance applications. This, in turn, simplifies remote entry of information, subsequent download of that information and integration of such information into each user's personal finance application.

Owner:INTUIT INC

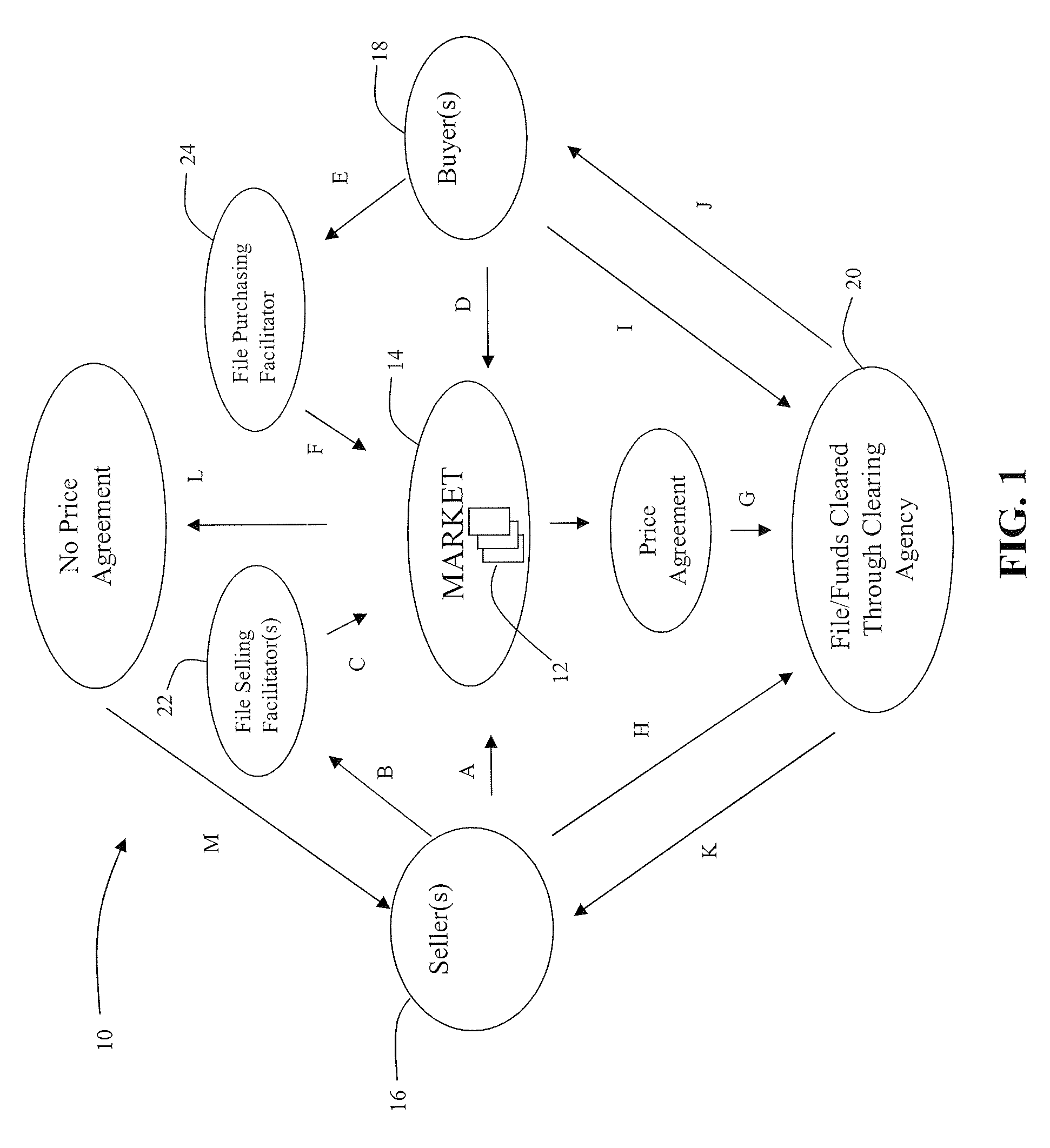

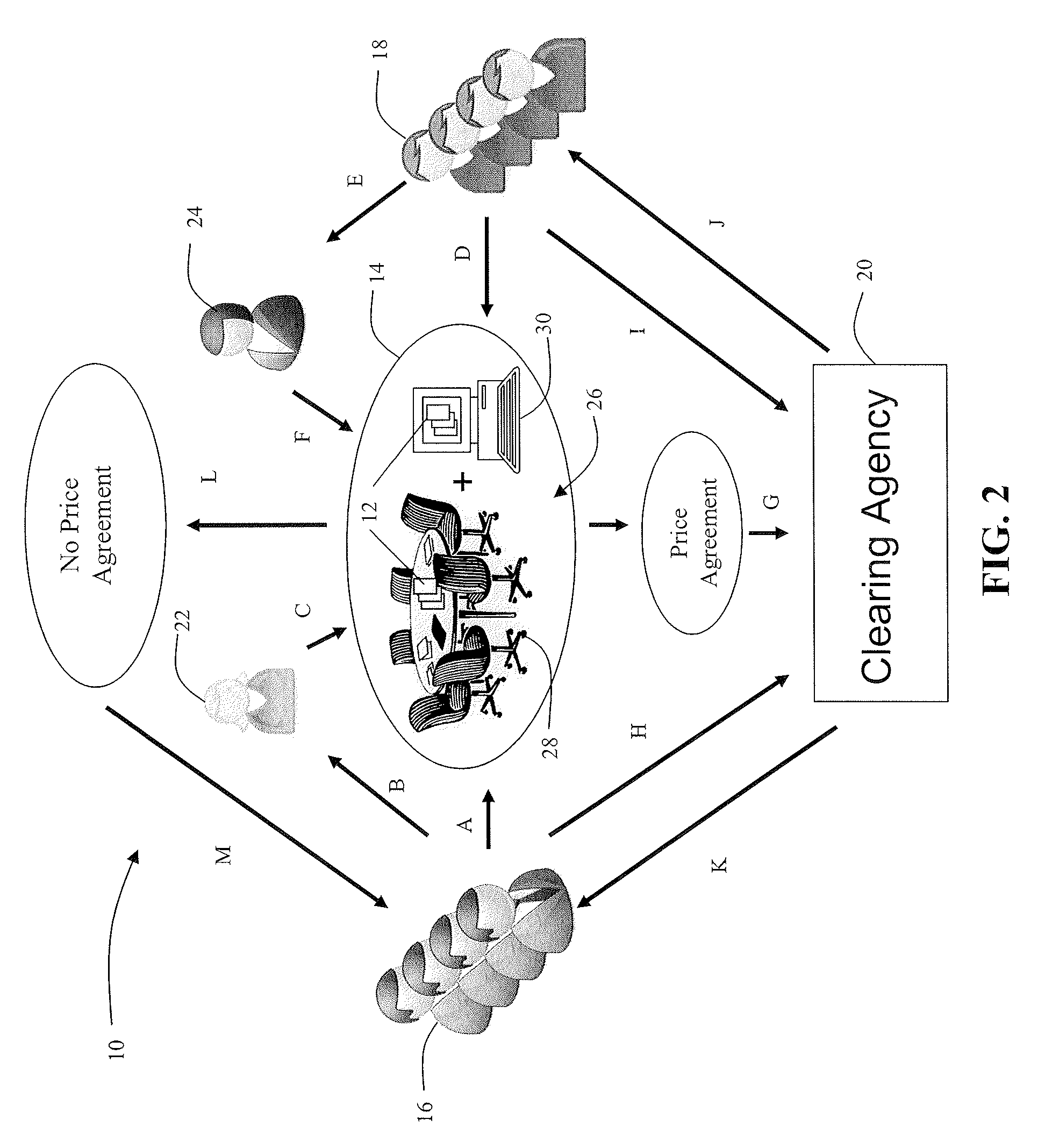

Systems and methods of trading closed loans, debt, and other financial obligations

A method of trading individual, closed residential mortgage loans without loans being presented in a structured pool. The method includes authorizing a file associated with an individual, closed residential mortgage loan to be made available to a plurality of potential buyers and converting information in the file into electronic file data for submittal to the plurality of potential buyers. The information in the file includes information of importance to the potential buyer in understanding the loan. The method also includes making the electronic file data available to the plurality of potential buyers for review and purchase without pooling or averaging the electronic file data prior to making it available to the plurality of potential buyers, and prior to bidding, thereby making the risk of the individual, closed mortgage loan transparent to the plurality of potential buyers; receiving a bid from one or more of the potential buyers on the individual, closed residential mortgage loan; accepting the bid and electronically forwarding a note associated with the file to a clearing agency for delivery to the potential buyer; and receiving funds from the clearing agency into a seller account as payment for the individual, closed residential mortgage loan.

Owner:GENERAL MORTGAGE FINANCE CORP

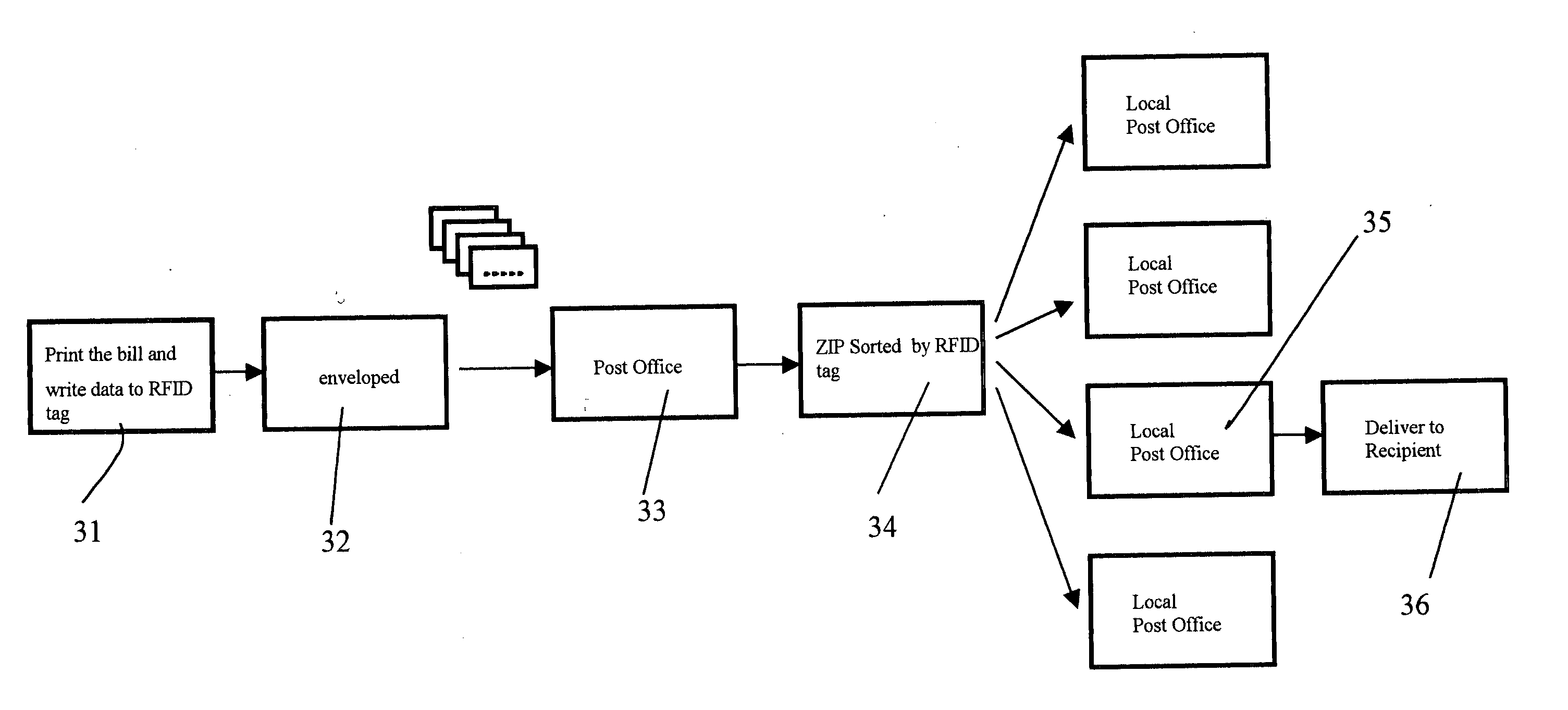

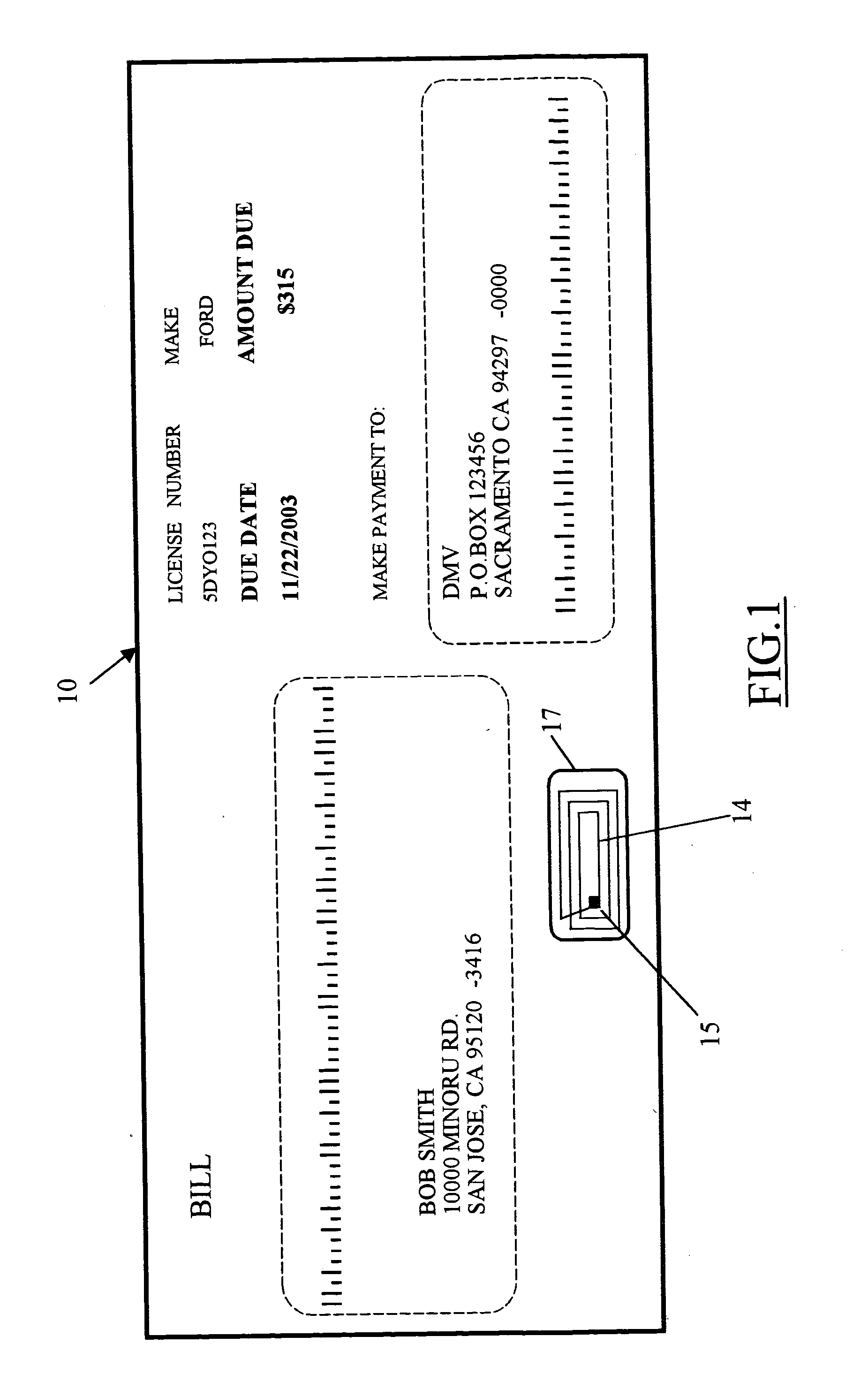

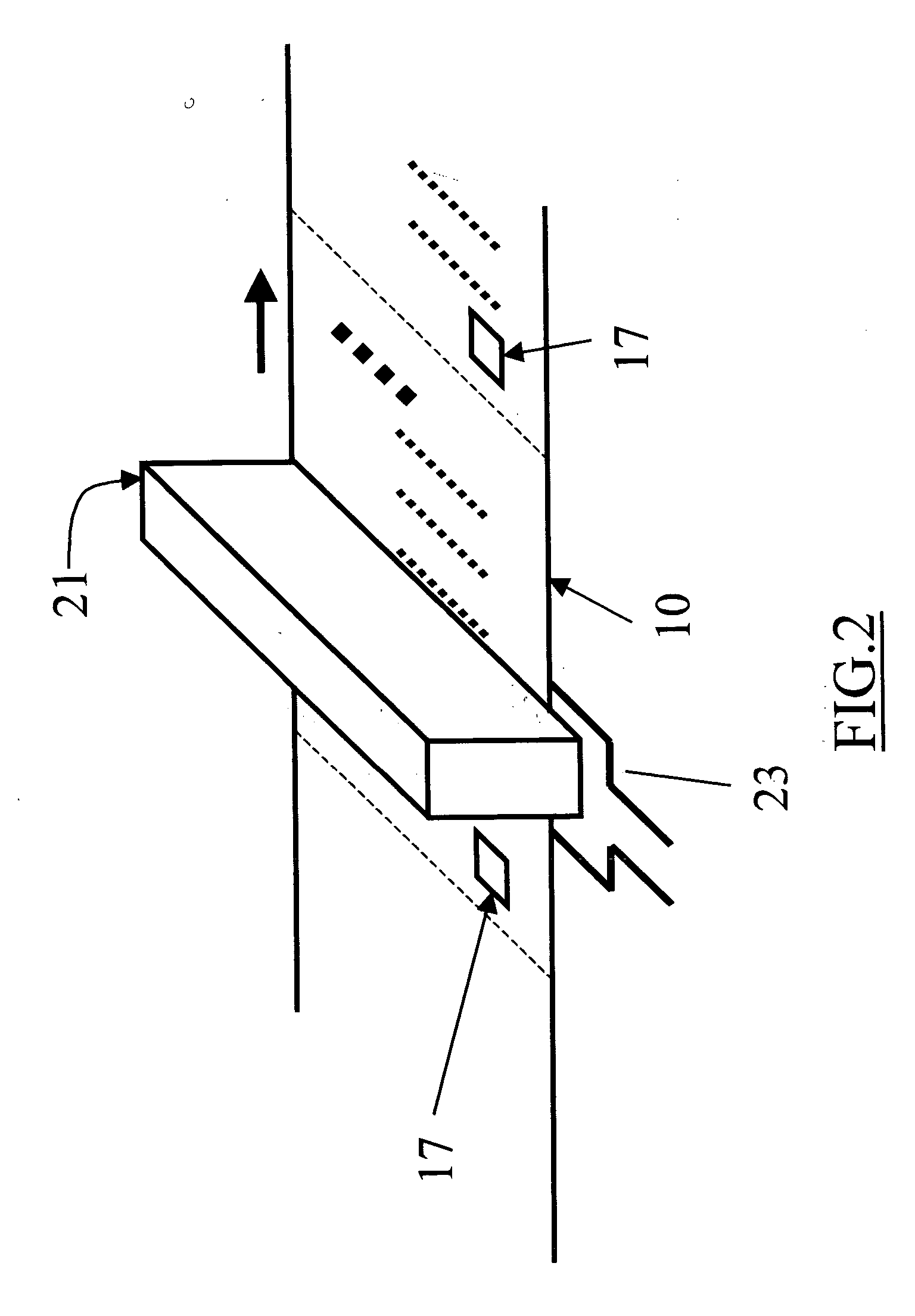

Intelligent billing system

InactiveUS20050177480A1High speed batch processingEliminate needComplete banking machinesTelephonic communicationPaymentDisplay device

An intelligent billing statement contains conventional visible printed billing information and an electronic copy stored in an rfid chip incorporated into the billing statement sheet media. Information stored in the rfid chip can be read out via a small antenna coupled to the chip and a reader antenna coupled to a reader without opening the envelope containing the billing statement. Envelopes containing billing statements can be read and sorted by the carrier at high speed. The recipient can read several statements simultaneously with a reader having a display with an optional imminent due date indicator. The reader has an optional communication link to a personal computer used for automatic bill payments and other financial applications.

Owner:SILICON VALLEY MICRO C

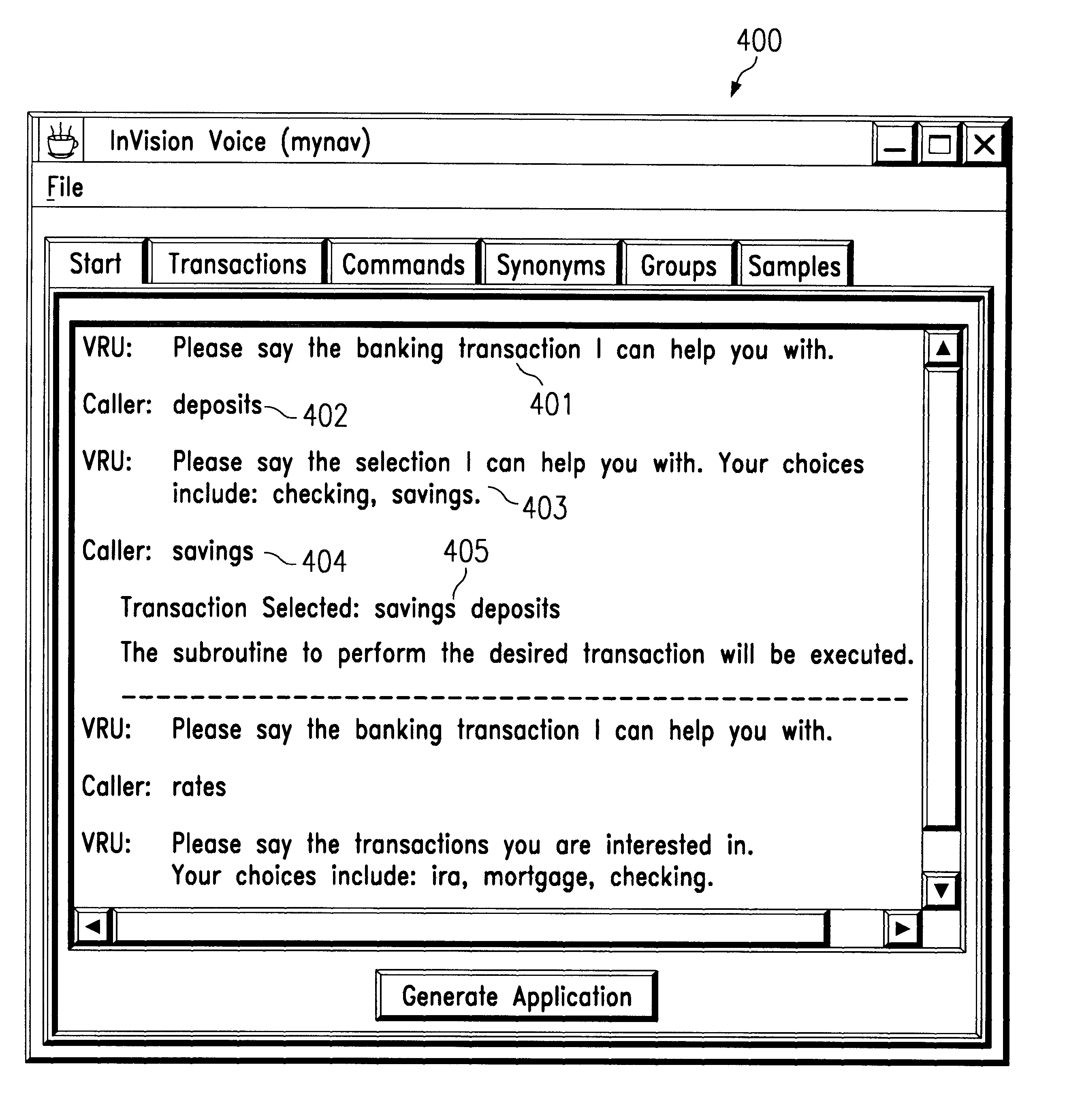

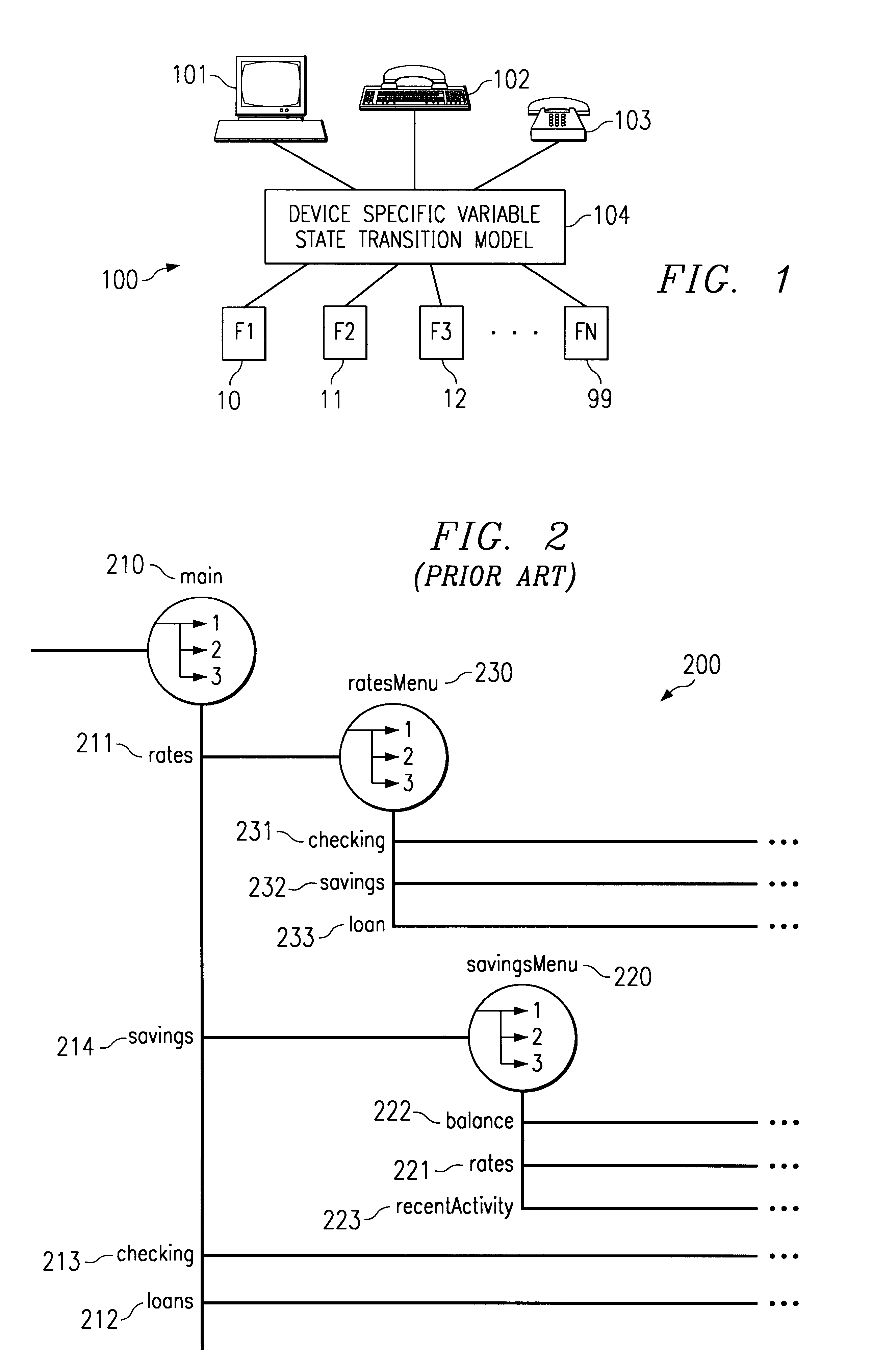

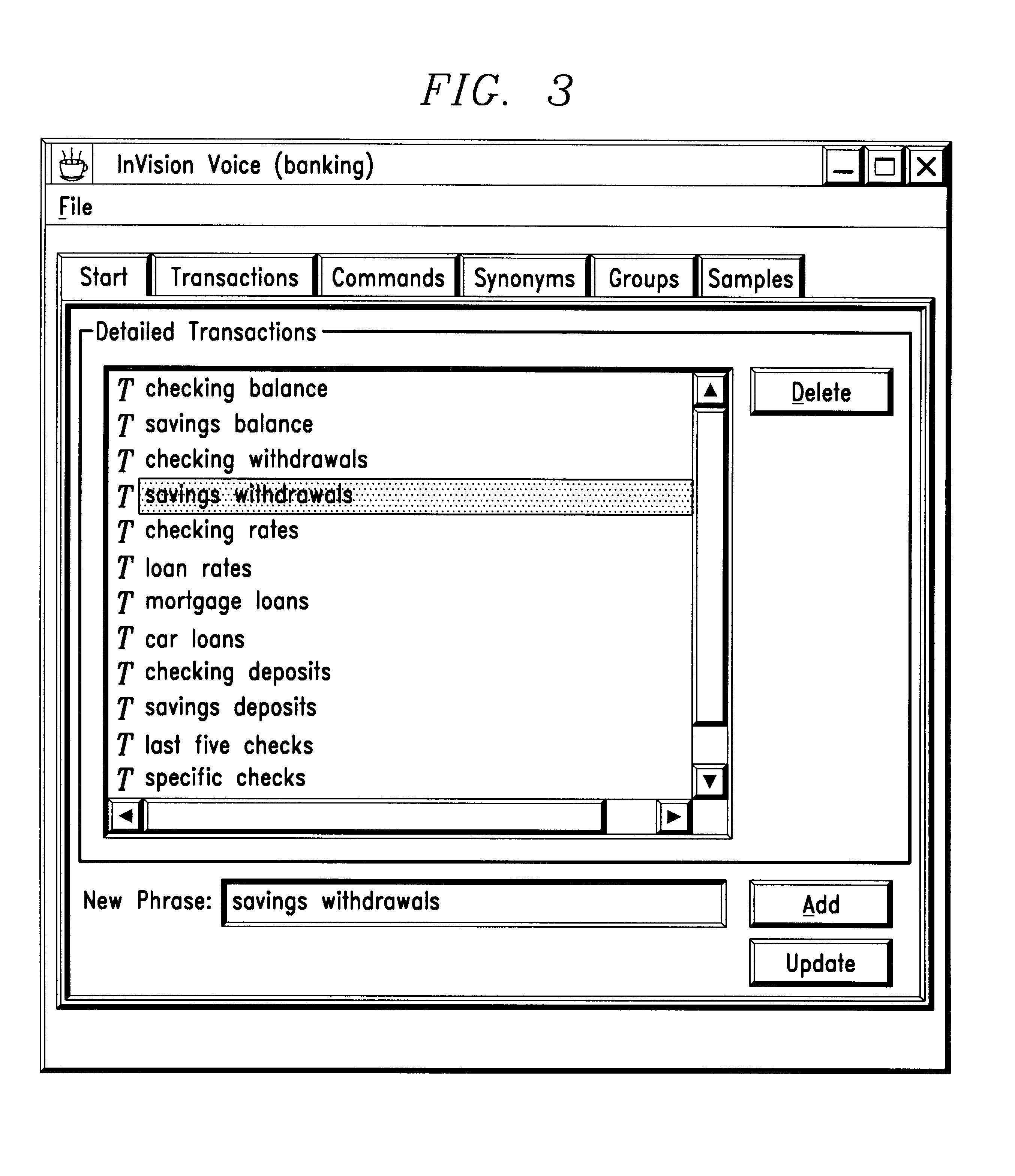

System and method to facilitate speech enabled user interfaces by prompting with possible transaction phrases

InactiveUS6178404B1Easy to createCreates delayAutomatic exchangesSpeech recognitionRunning timeComputer science

The invention relates to a voice enabled user interface which correlates, at development time or at run time, utterances, by a caller who is interacting with the user interface, with transaction phrases in a transaction phrase data structure, such as through the use of synonyms, descriptions of the transactions, comparing selected words, and phrases having one or a plurality of word in common. The user interface employs the results of the correlation to calculate an offering to the caller which may include a list of transaction phrases, a list of correlation results, a prompt for the caller to speak additional information to the user interface, or a combination of the two. The user interface may assess whether a number of transaction phrases in a determined list is small enough to be suitable for presentation and, if not, enable a correlating step to be repeated to yield a smaller number of transaction phrases in the correlation result. The invention may be employed in a variety of applications including but not limited to banking and other financial applications services.

Owner:INTERVOICE PARTNERSHIP

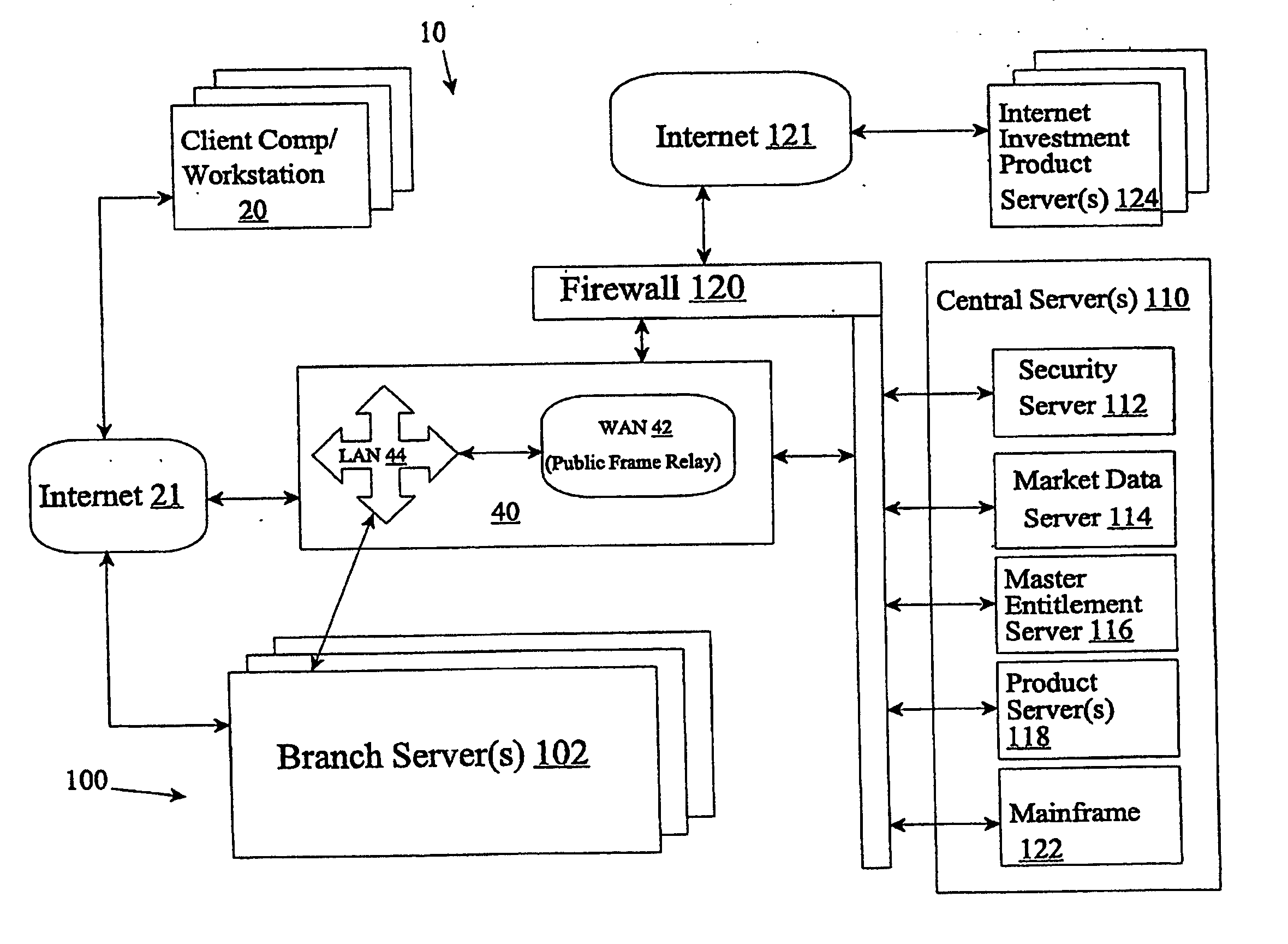

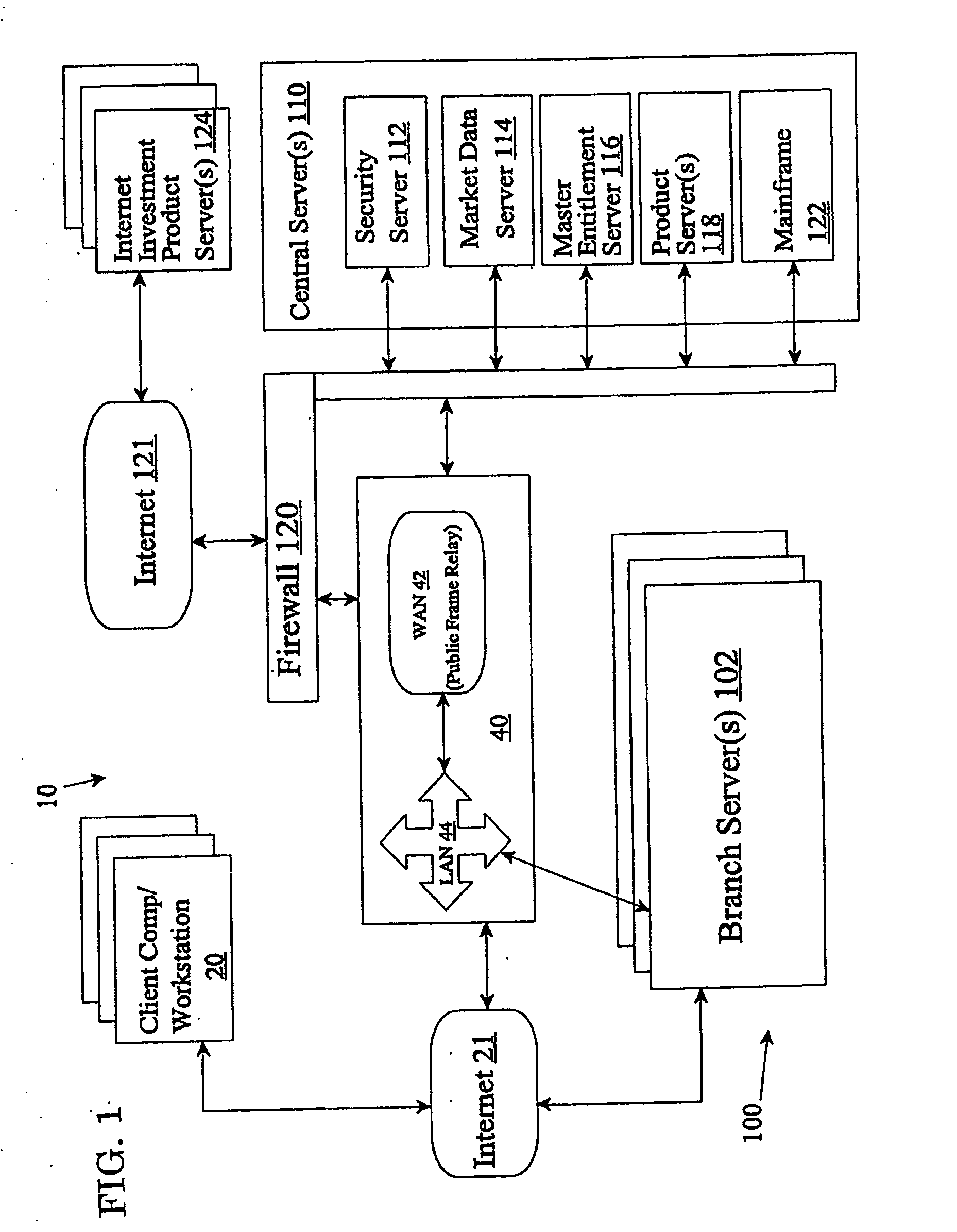

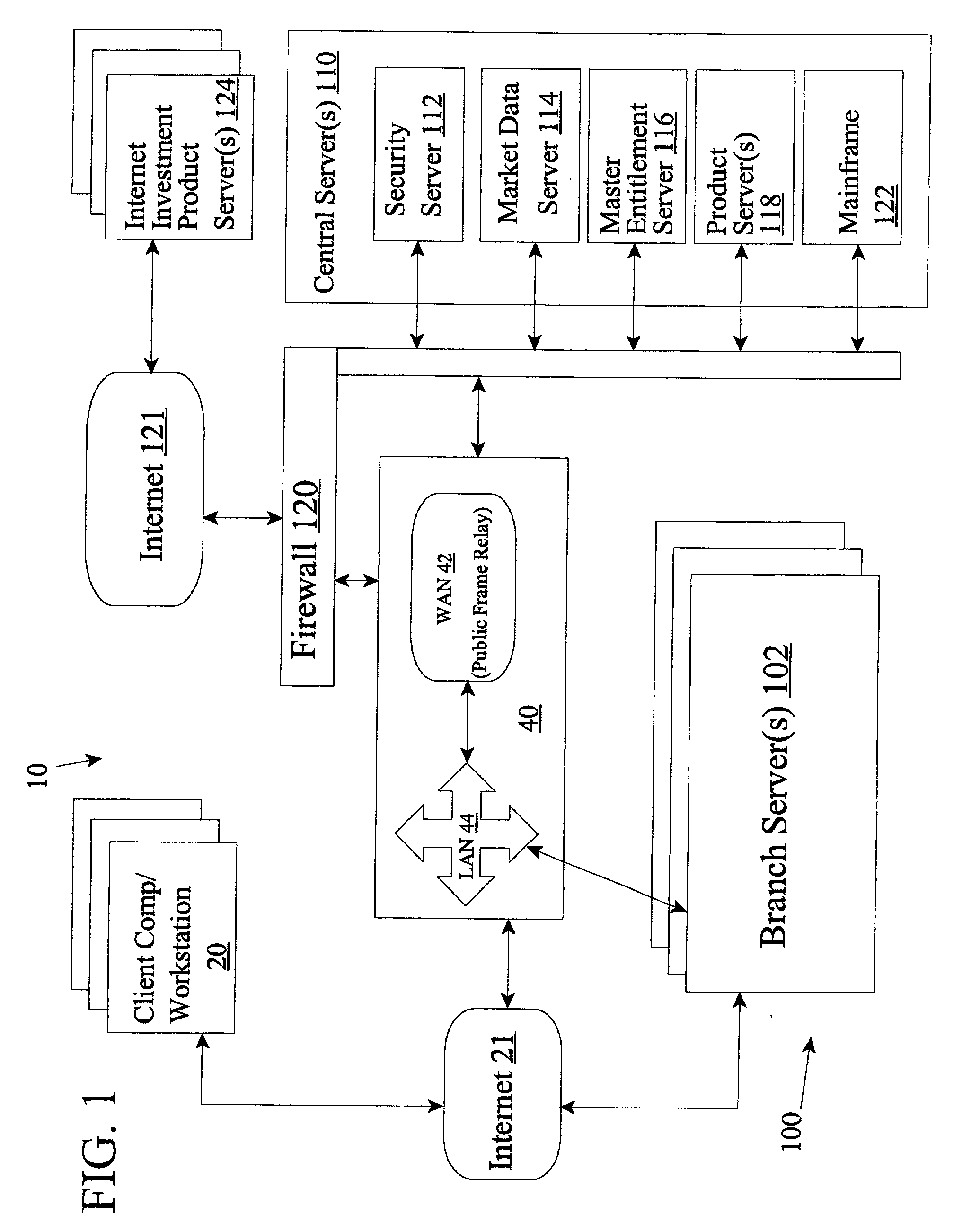

Systems for providing financial services

The present invention provides an intranet system for a financial service corporation. The present invention also provides a browser interface for financial services. The interface comprise a toolbar; a task menu wherein each task is associated with a number of financial applications; an object menu associated with each task which provides a link to each financial application; and an action menu for presenting one or more actions specific to a user-selected financial application. The task menu is always present on the browser interface and the object and action menus vary depending upon the options selected. The financial applications include market monitoring functions, portfolio reviews, model balancing, and automated trading.

Owner:UBS AG

Browser interface and network based financial service system

InactiveUS7171384B1Proactive financialStable and fast operating environmentFinanceOffice automationInternet accessClient-side

A browser interface for providing financial services is provided. The interface comprise a toolbar; a menu for presenting one of an application menu and a market data function menu; and at least one view window for presenting information from at least one of an application and a market data function. Also provided is a network based financial service system comprising a client computer having Internet access; a browser interface operable on the client computer, the browser interface having a toolbar, a menu for presenting one of an application menu and a market data function menu, and at least one view window for presenting information from at least one of a financial application and a market data function; and a server having access to a plurality of applications and a plurality of market data functions, the applications and functions being accessible from the browser interface of the Internet access. The interface and system provides timely, proactive financial advice. Users are afforded the opportunity to set and achieve investment goals based on real-time financial data and the ability to access financial applications.

Owner:UBS BUSINESS SOLUTIONS AG

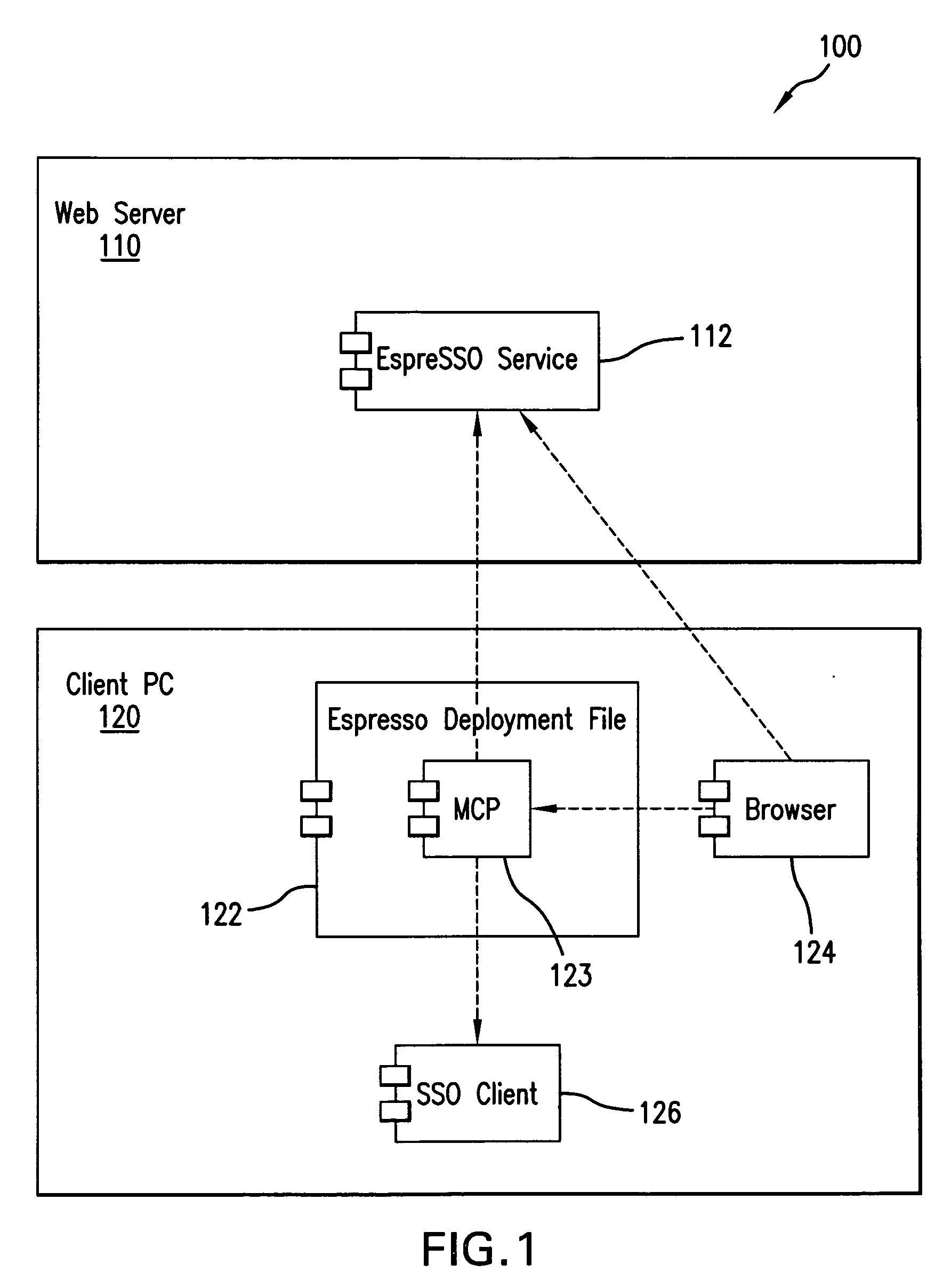

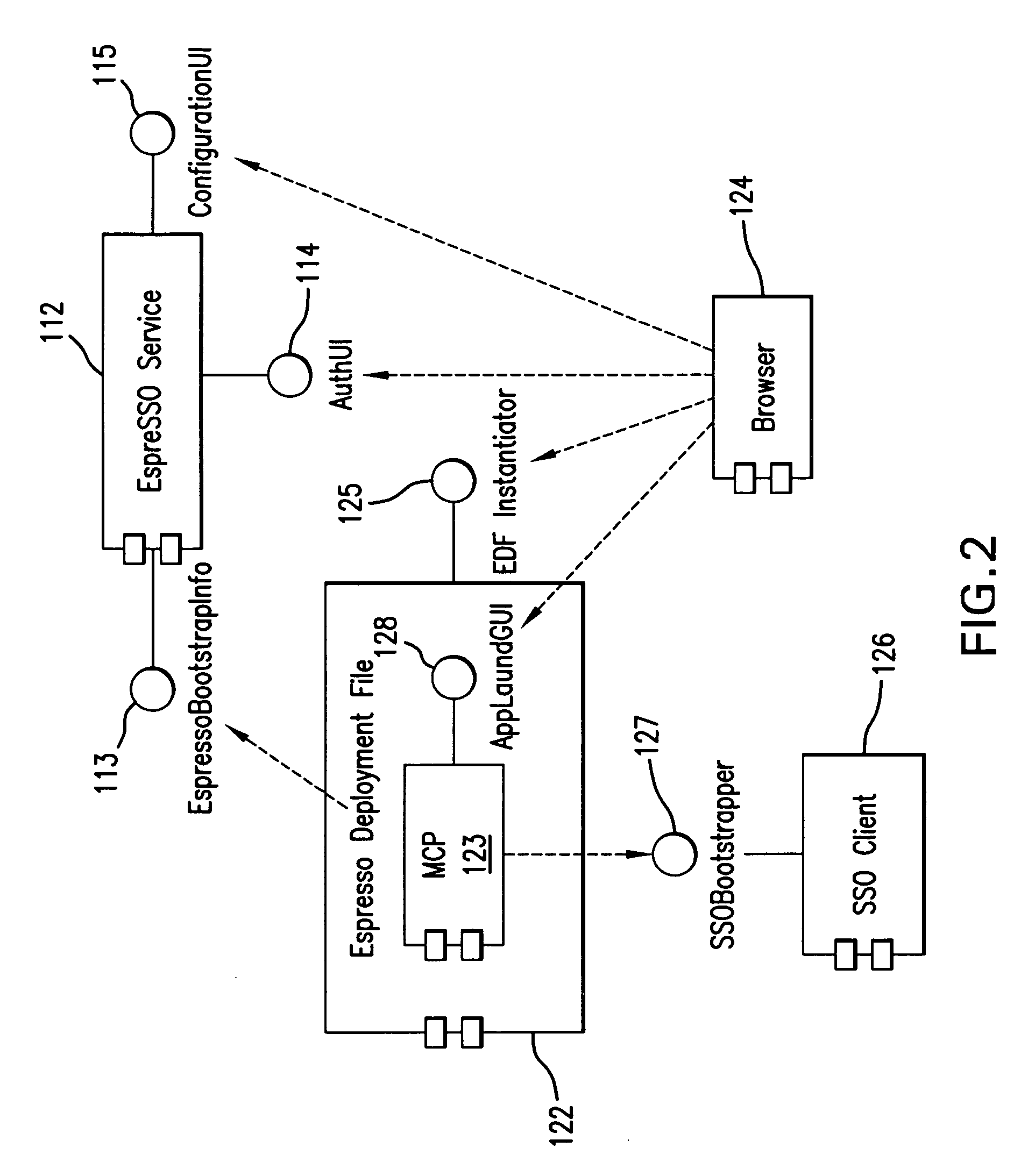

Method and system for providing user access to a secure application

InactiveUS20070157298A1Facilitates reduced and single sign on type remote accessRandom number generatorsUser identity/authority verificationWeb browserPassword

A method and system for providing remote user access to secure financial applications by deployment of SSO software (126) to client workstations (120), including receiving a password for collaborating access to a secure server (110); navigating to the secure server (110) using a web browser (124) on a remote workstation (120); providing user authorisation details and the received password to the secure server (120); generating a subsequent password at the secure server (110) upon validation of the user authorisation details and received password; downloading an SSO deployment file (122) to the remote workstation (120), said deployment file (122) including the subsequent password; executing the SSO deployment file (122) to install an SSO client application (126) on the remote workstation; reading workstation settings and user credentials from a secure file or data store; and running the SSO client application (126) on the workstation to employ the user credentials and subsequent password to logon to the secure application.

Owner:ACTIVIDENTITY AUSTRALIA

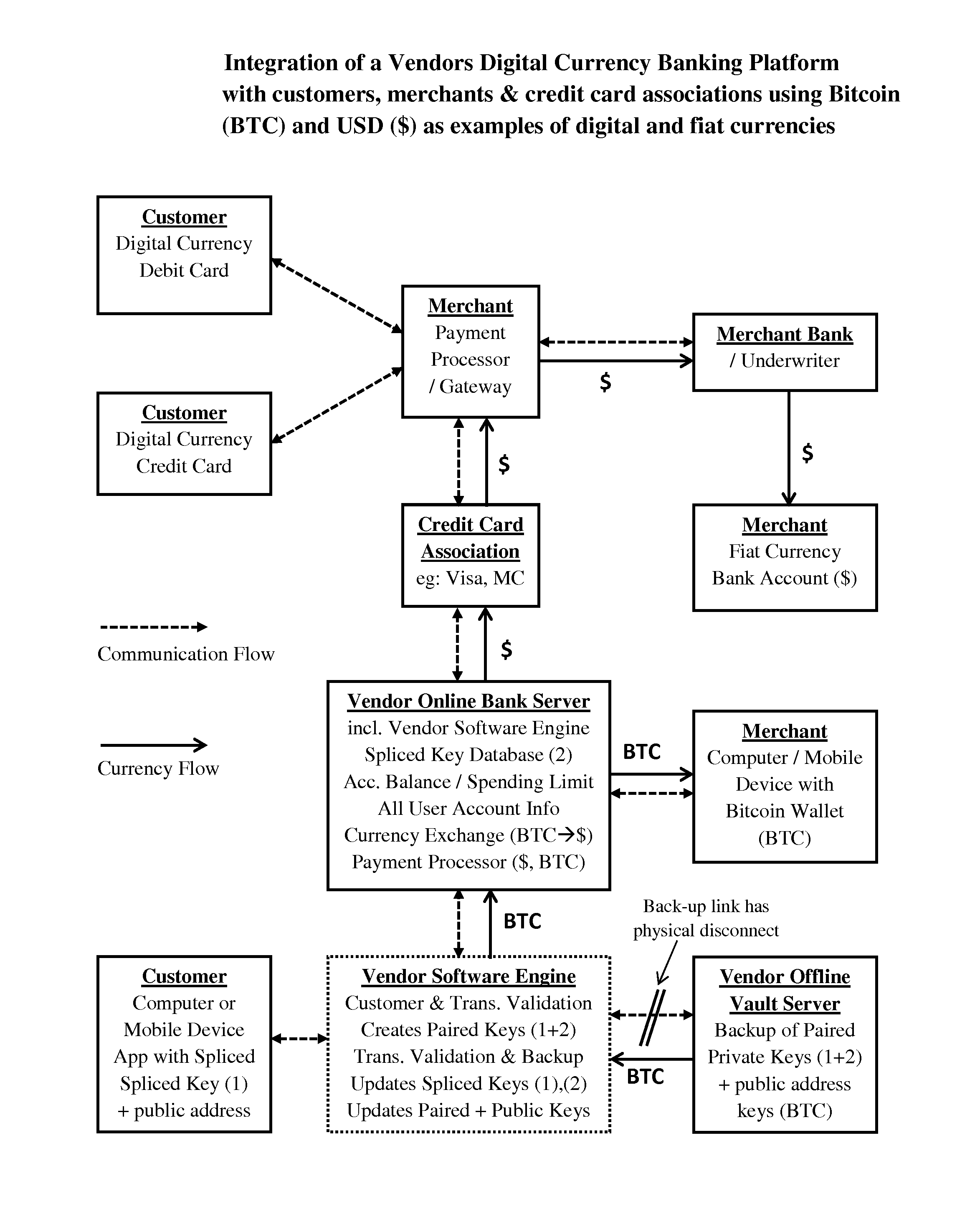

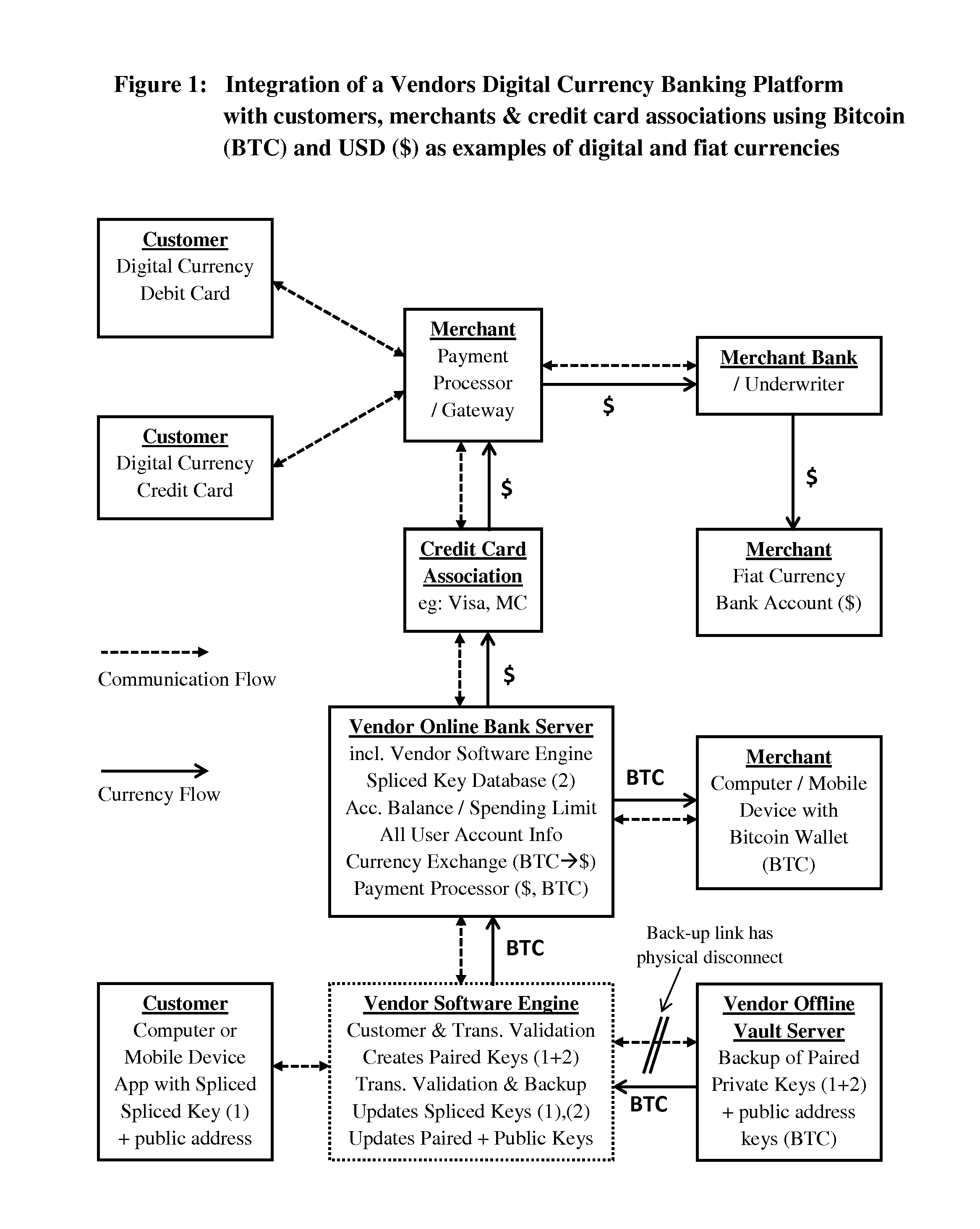

System and method for digital currency storage, payment and credit

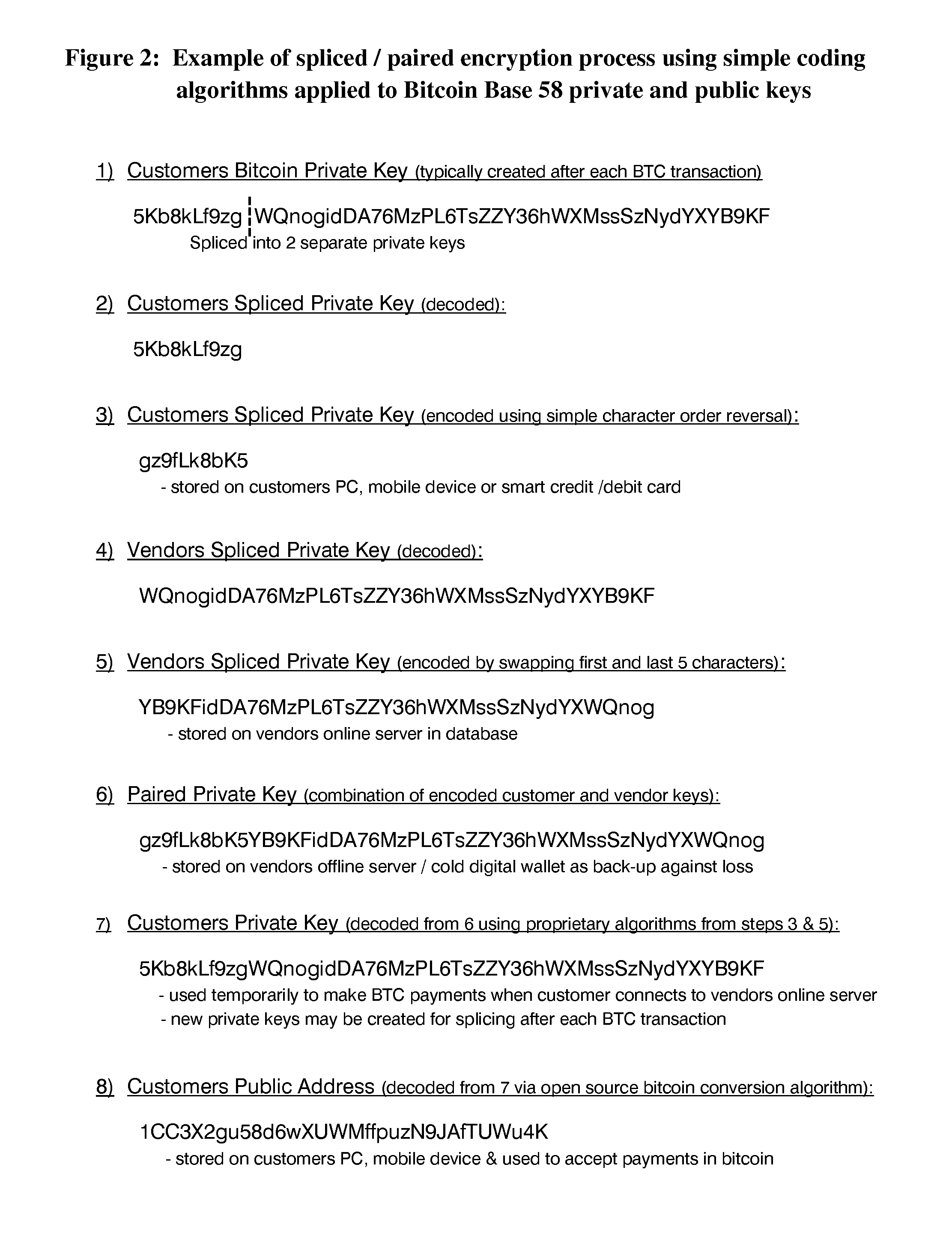

InactiveUS20160335628A1Improved credit/debit card security benefitIncreased level securityComputer security arrangementsPayment protocolsDigital currencyStorage security

A system and method for the secure online storage of digital currency or crypto-currency assets, and the secure use of stored online digital currency assets for financial payment transactions and credit lending transactions in either digital currency or fiat currency. The present invention includes various methods for the encryption and secure online storage of a digital currency wallet using spliced / paired design architecture, and various methods for the integration of secure digital currency online wallets with online banking platforms, debit card devices, credit card devices, credit lending networks, merchant payment processors and credit card associations. The present invention also relates to the use of spliced / paired design architecture for non-financial applications that improve the online storage security of other types of data files and document files that are not related to digital currency or financial transactions.

Owner:CRYPTYK INC

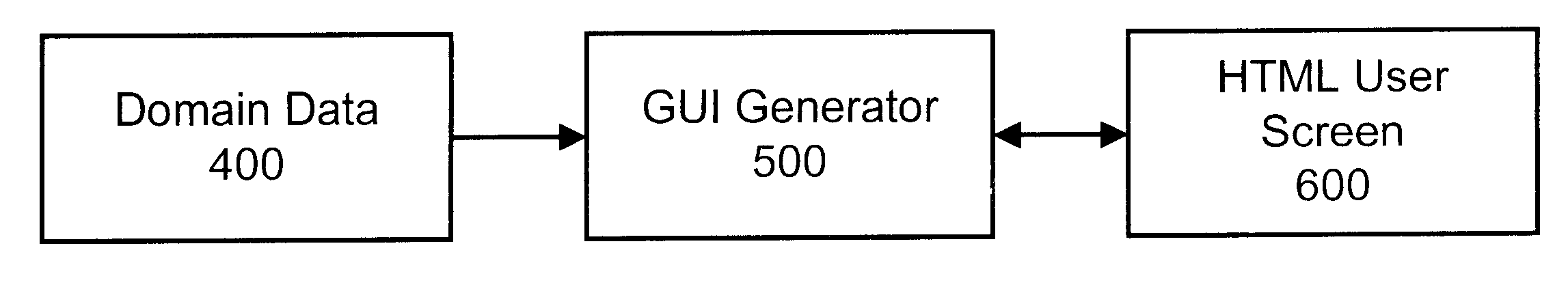

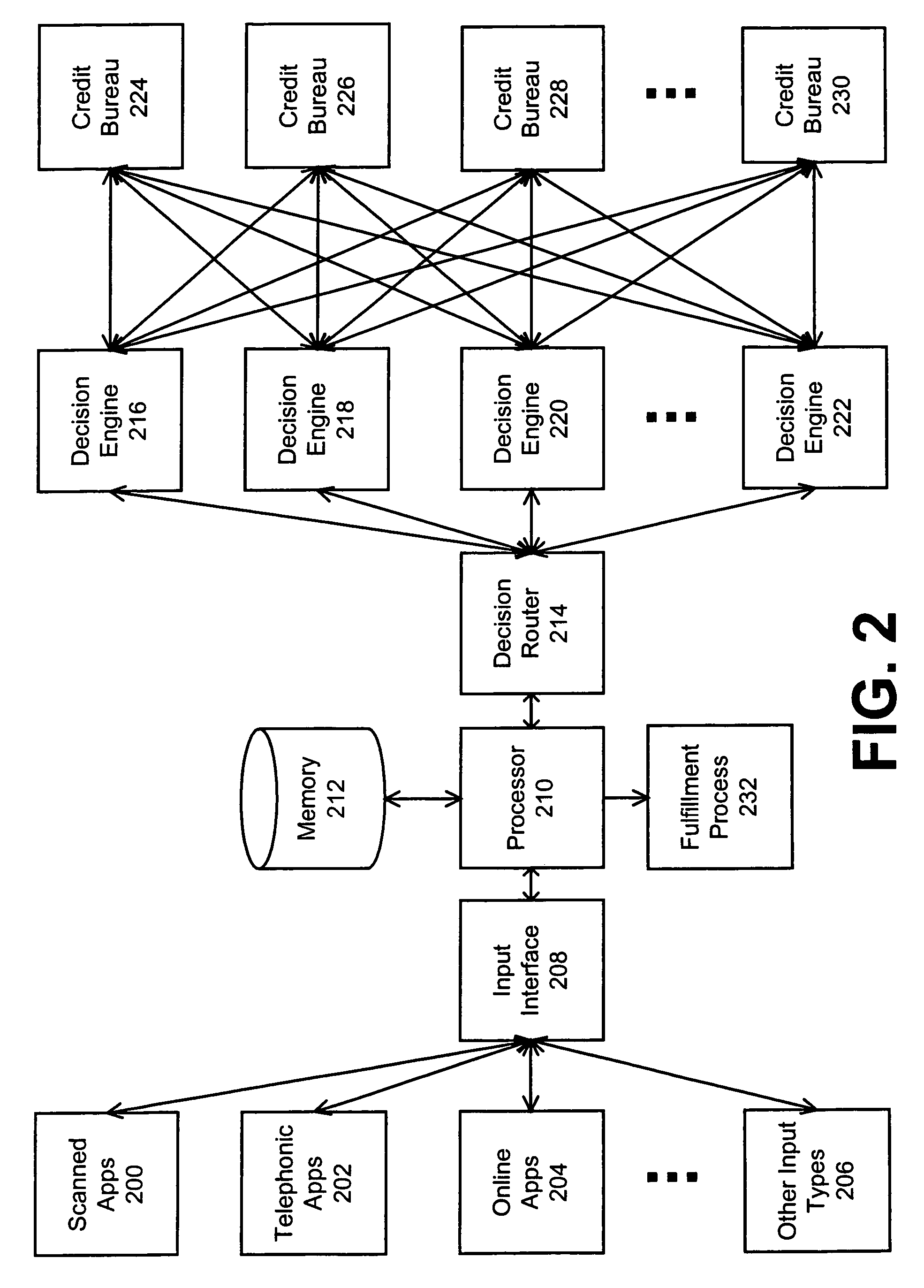

System and method for generating graphical user interfaces

InactiveUS6867789B1Convenient for consumerEasy to useFinanceCharacter and pattern recognitionGraphicsGraphical user interface

An automated method for generating Graphical User Interfaces (GUI's) is illustrated in the context of a system for processing financial applications. In one embodiment, the GUI generator converts domain data representing over one thousand application types into an equal number of corresponding user screens. The interface may also be bi-directional, operating on user inputs to validate data or check for double keying.

Owner:CHASE MANHATTAN BANK USA NAT ASSOC

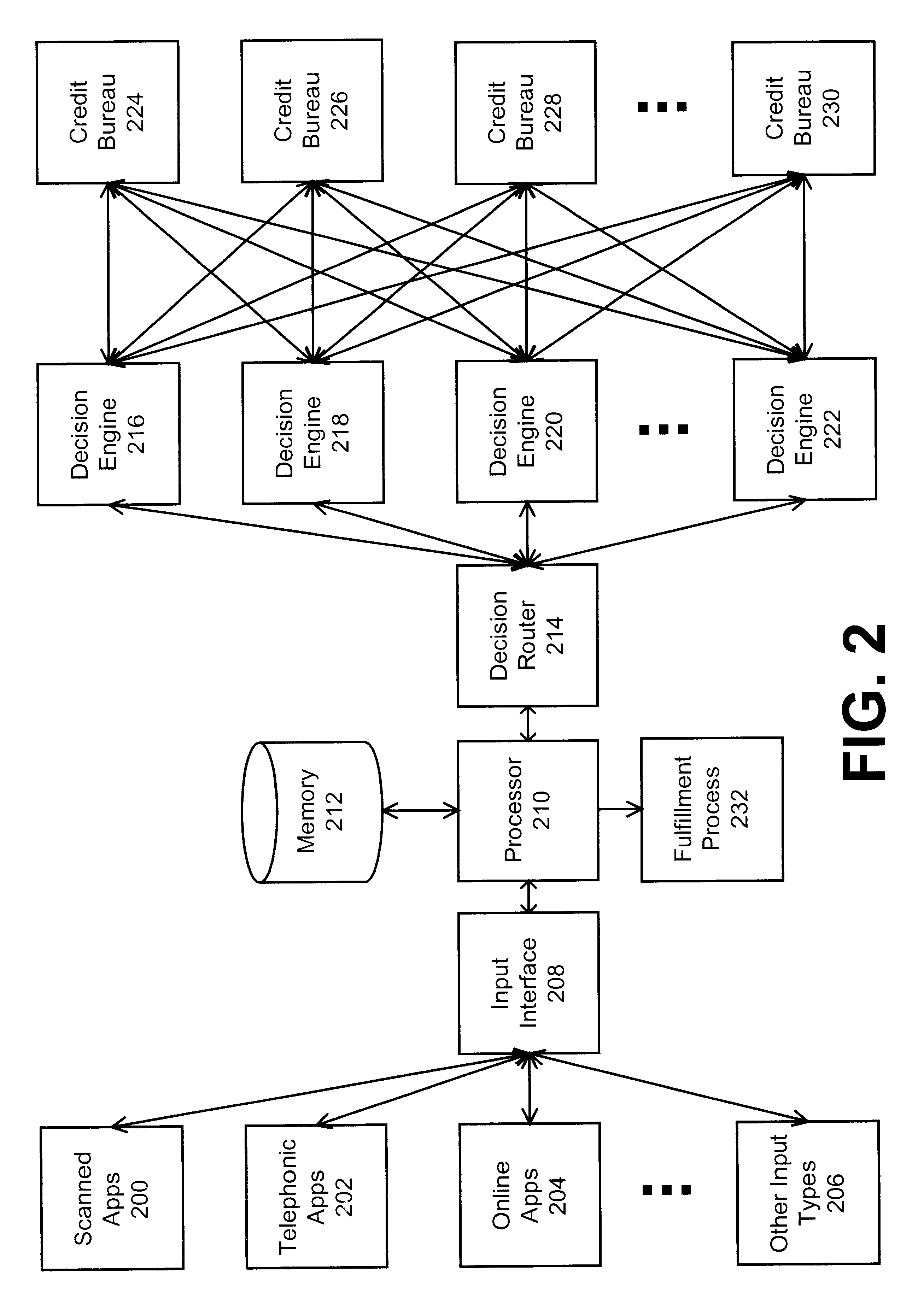

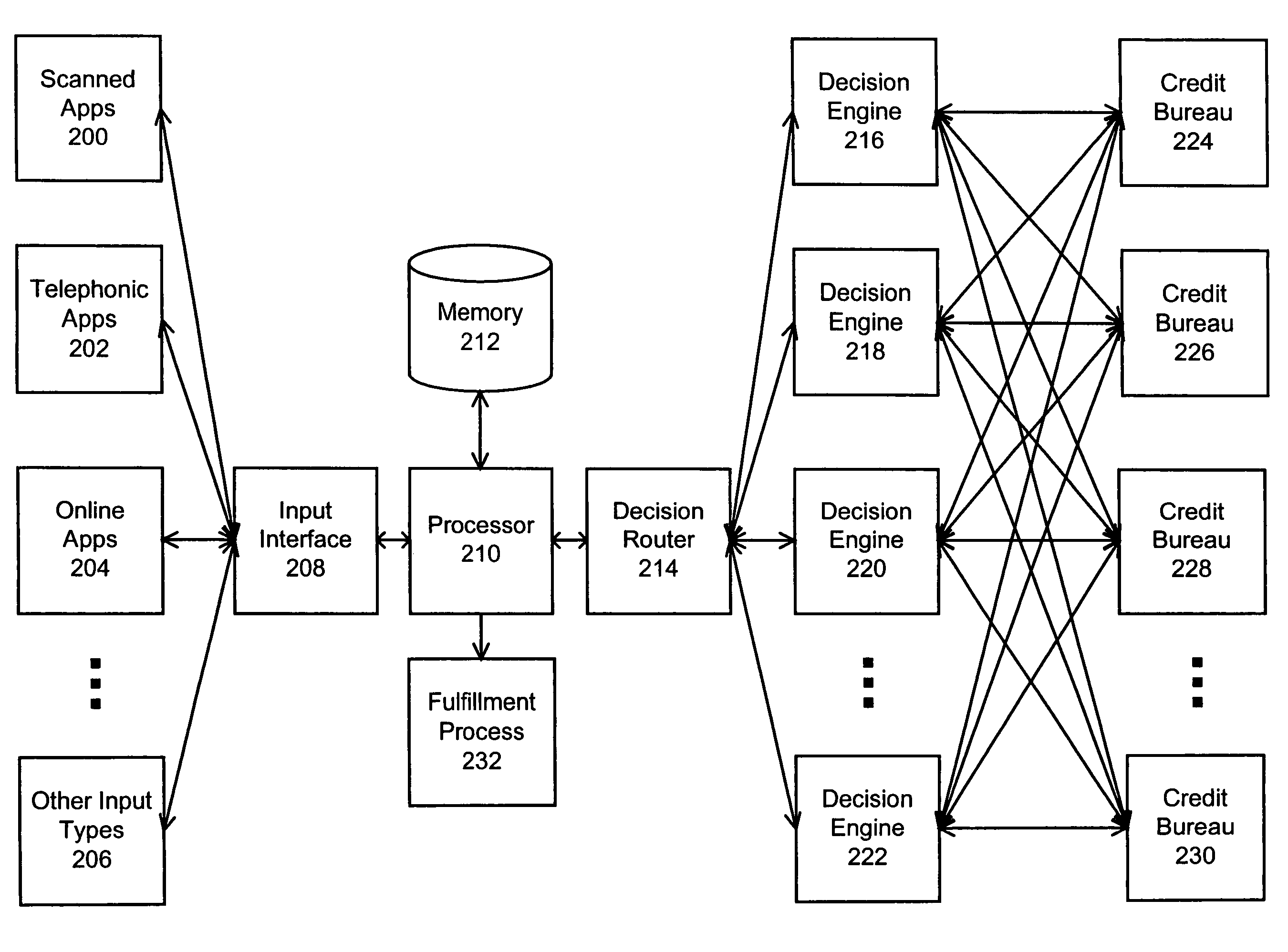

System and method for processing applicant input information

ActiveUS7676751B2Easy to useMore data being inputFinanceCharacter and pattern recognitionGraphicsGraphical user interface

An automated method for generating Graphical User Interfaces (GUI's) is illustrated in the context of a system for processing financial applications. In one embodiment, the GUI generator converts domain data representing over one thousand application types into an equal number of corresponding user screens. The interface may also be bidirectional, operating on user inputs to validate data or check for double keying.

Owner:CHASE MANHATTAN BANK USA NAT ASSOC

Systems and methods for providing virtual currencies

Systems and methods for conducting reliable financial transactions, credit decisions, and security assessments are provided. Connectivity values may be assigned to members of a community by users, third parties, or automatically based on the frequency of interactions between members of the community. Connectivity values may represent such factors as alignment, reputation within the network community, or the degree of trust. Information about a financial transaction may be automatically published to other qualifying members of the community based on connectivity values. The other qualifying members may then be given the opportunity to participate in the same financial transaction or access the same financial application in order to initiate their own financial transaction, or to take action based on information about the financial transaction, credit decision, and / or security assessment. These transactions may also be based on virtual and / or electronic currencies.

Owner:WWW TRUSTSCI COM INC

Systems and methods for conducting more reliable financial transactions, credit decisions, and security assessments

Systems and methods for conducting more reliable financial transactions, credit decisions, and security assessments are provided. A user may assign user connectivity values to other members of the community, or connectivity values may be automatically harvested or assigned from third parties or based on the frequency of interactions between members of the community. Connectivity values may represent alignment, reputation within the network community, or the degree of trust. Information about a financial transaction initiated by a first member of the community, a credit decision, and / or a security assessment may be automatically published to other qualifying members of the community based on connectivity values. The other qualifying members may then be given the opportunity to participate in the same financial transaction or access the same financial application in order to initiate their own financial transaction, or to take action based on information about the financial transaction, credit decision, and / or security assessment.

Owner:WWW TRUSTSCI COM INC

Real-time monitoring method and monitoring apparatus for online business of financial application system

InactiveCN106210021AImplementation statusRealize automatic alarmFinanceTransmissionStatistical analysisOnline business

The invention provides a real-time monitoring method and monitoring apparatus for an online business of a financial application system. The apparatus comprises a request processing module that acquires trading request information of the online business of the financial application system from a request cluster queue, a response processing module that acquires trading response information of the online business of the financial application system from a response cluster queue and obtains trading information according to the trading request information and the trading response information, a statistics analysis module that scans a basic data region and an extended data region of a memory and writes an alarm index into a data analysis region of the memory, and an alarm release module that scans the data analysis region of the memory, matches an alarm parameter group and pushes the alarm index and alarm information to a monitoring module for performing display when the matching succeeds. Therefore, second-level real-time graphic state monitoring and automatic alarming are realized, security pre-warning time of the system is greatly shortened, and information security of important business systems is protected.

Owner:BANK OF CHINA

Application ecosystem and authentication

InactiveUS20130325680A1Matched savings opportunity may improveImprove targetingFinanceTelephonic communicationApplication softwareMachine learning

Disclosed herein is a method for financial institutions to provide value added services to customers while preserving security of customer financial information. The method comprising providing a single point of access to a centralized platform wherein the platform may host one or more financial applications, enabling the selection and configuration of the one or more financial applications, sharing anonymized customer financial information between the financial institution and the one or more financial applications via a single conduit, analyzing the financial information by the financial applications, receiving results from the one more financial applications via the single conduit and displaying the results to the customer.

Owner:TRUAXIS

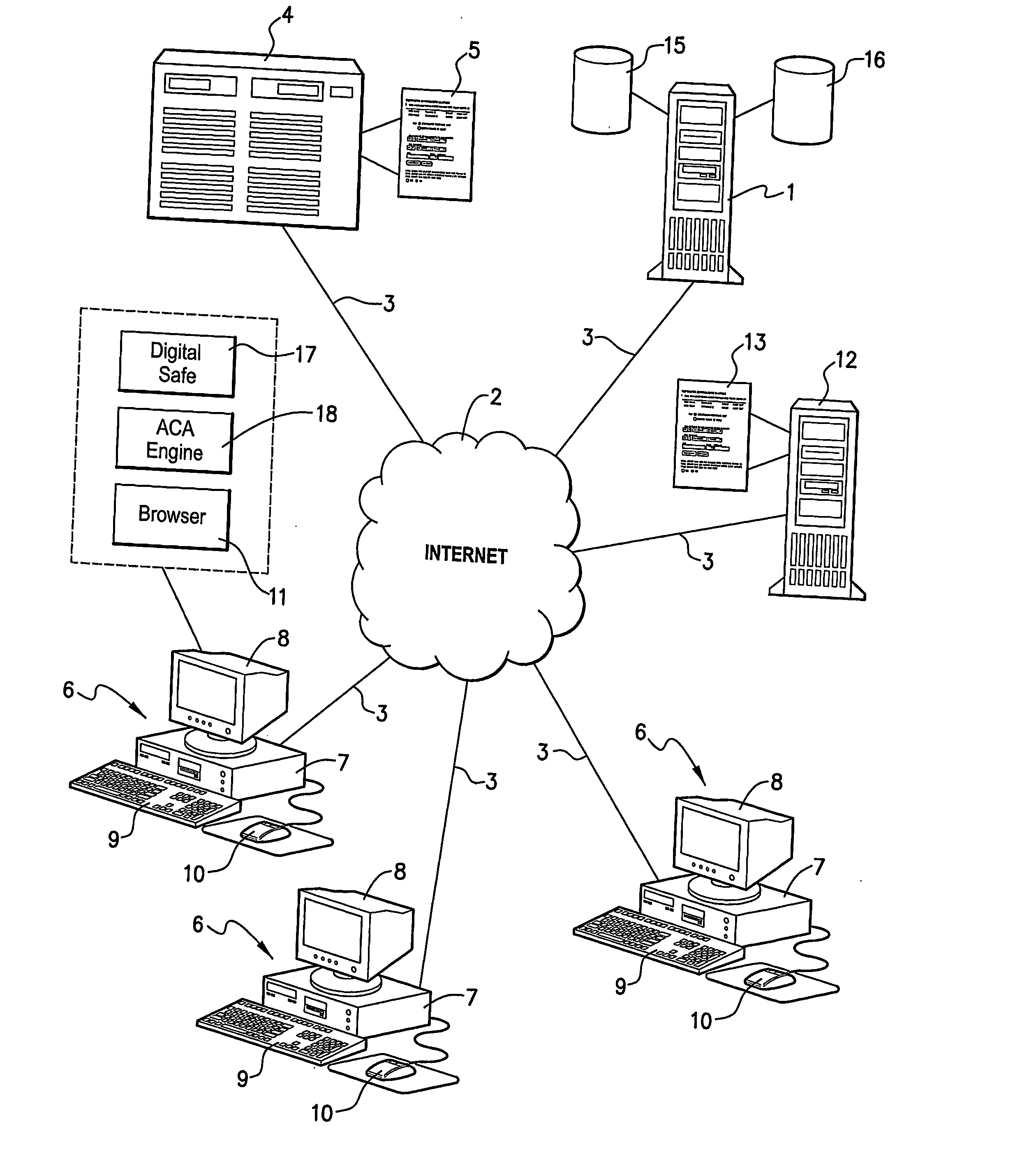

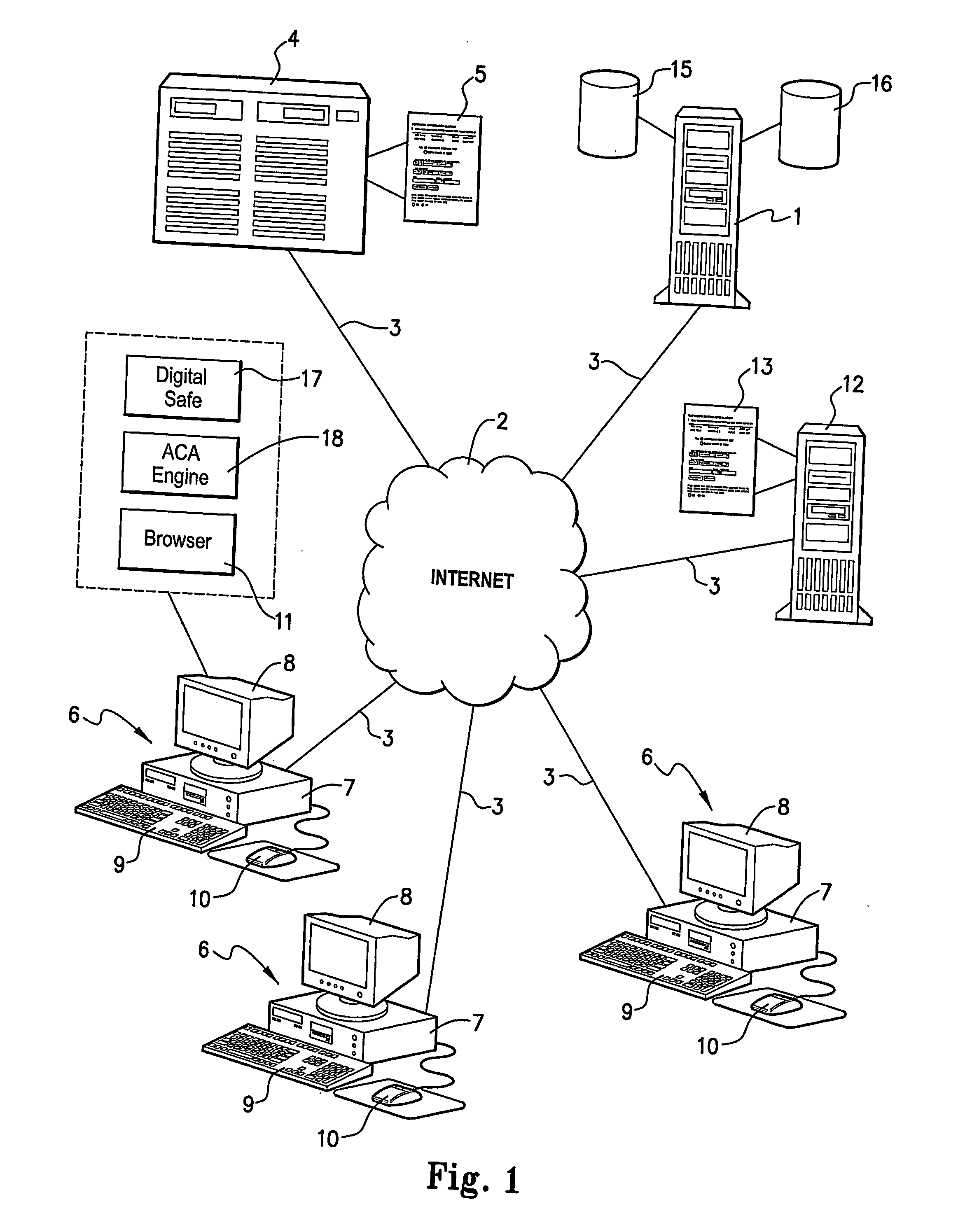

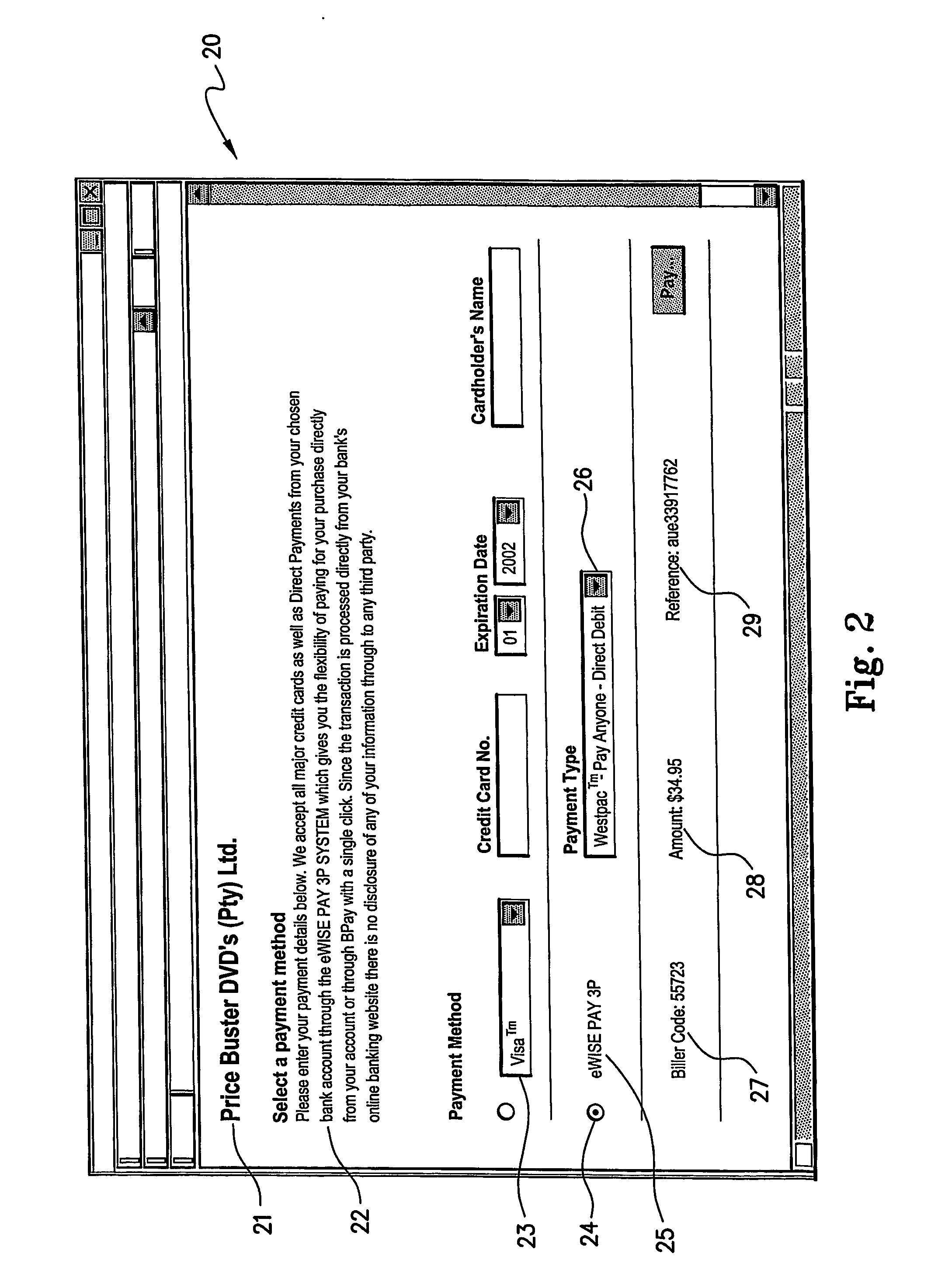

System and method for facilitating on-line payment

ActiveUS20070100770A1Avoids fraudulent generationReduce chanceDebit schemesSecret communicationWeb siteCredit card

The present invention relates to a system and method for facilitating on-line payment particularly for goods or services purchased via a merchant site on the Internet. The system enables payment from an existing customer account at a financial institution, but does not require the user to provide credit card details. The payment is implemented in real-time from the customer account to a merchant account via a financial institution application such as an Internet banking website. An interface is provided which is initiated via the merchant site and which then interfaces the customer computer to the financial application having access to the customer computer's account. The customer can then enter payment details directly with the financial institution to pay the merchant directly for the transaction.

Owner:PAYWITHMYBANK

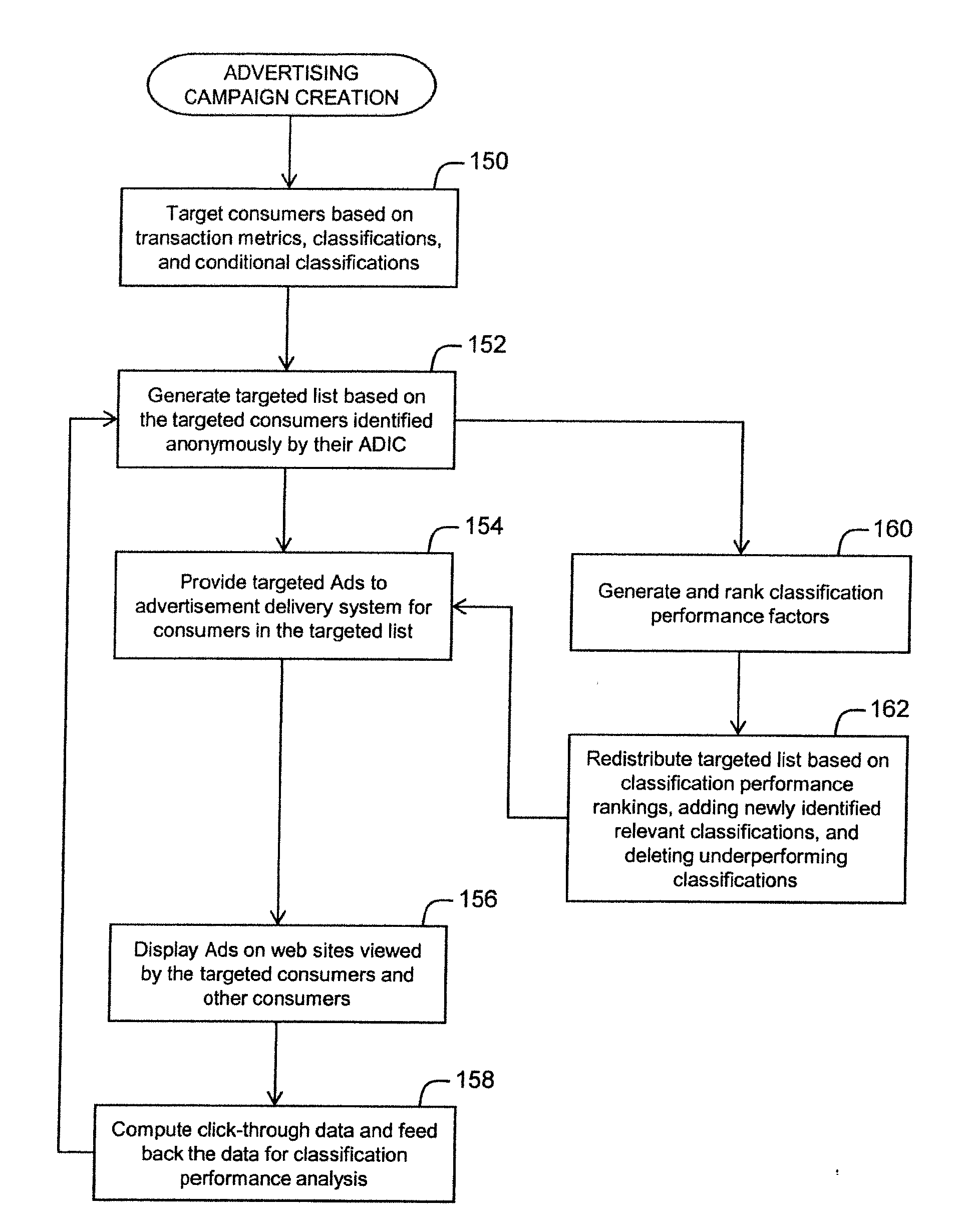

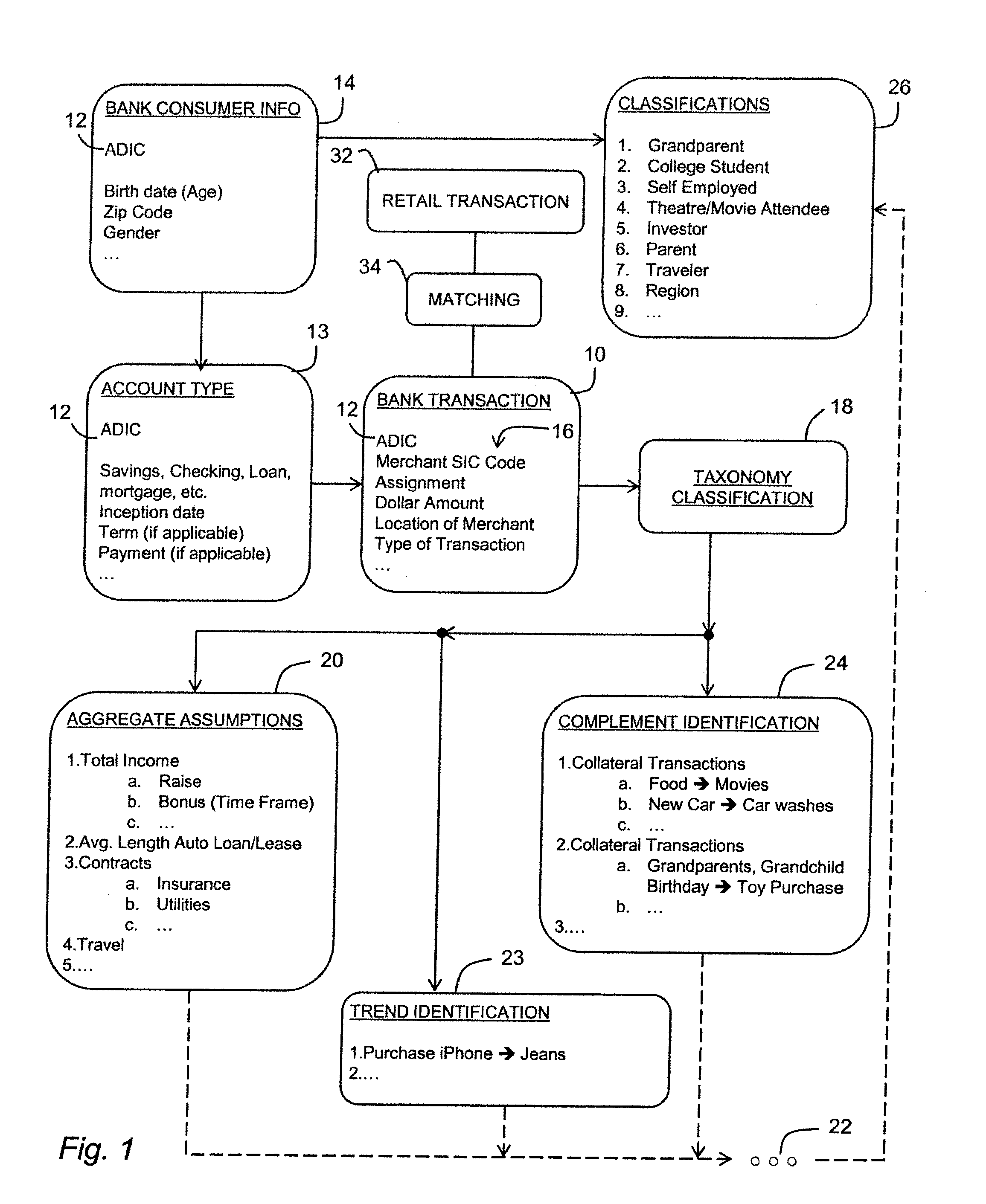

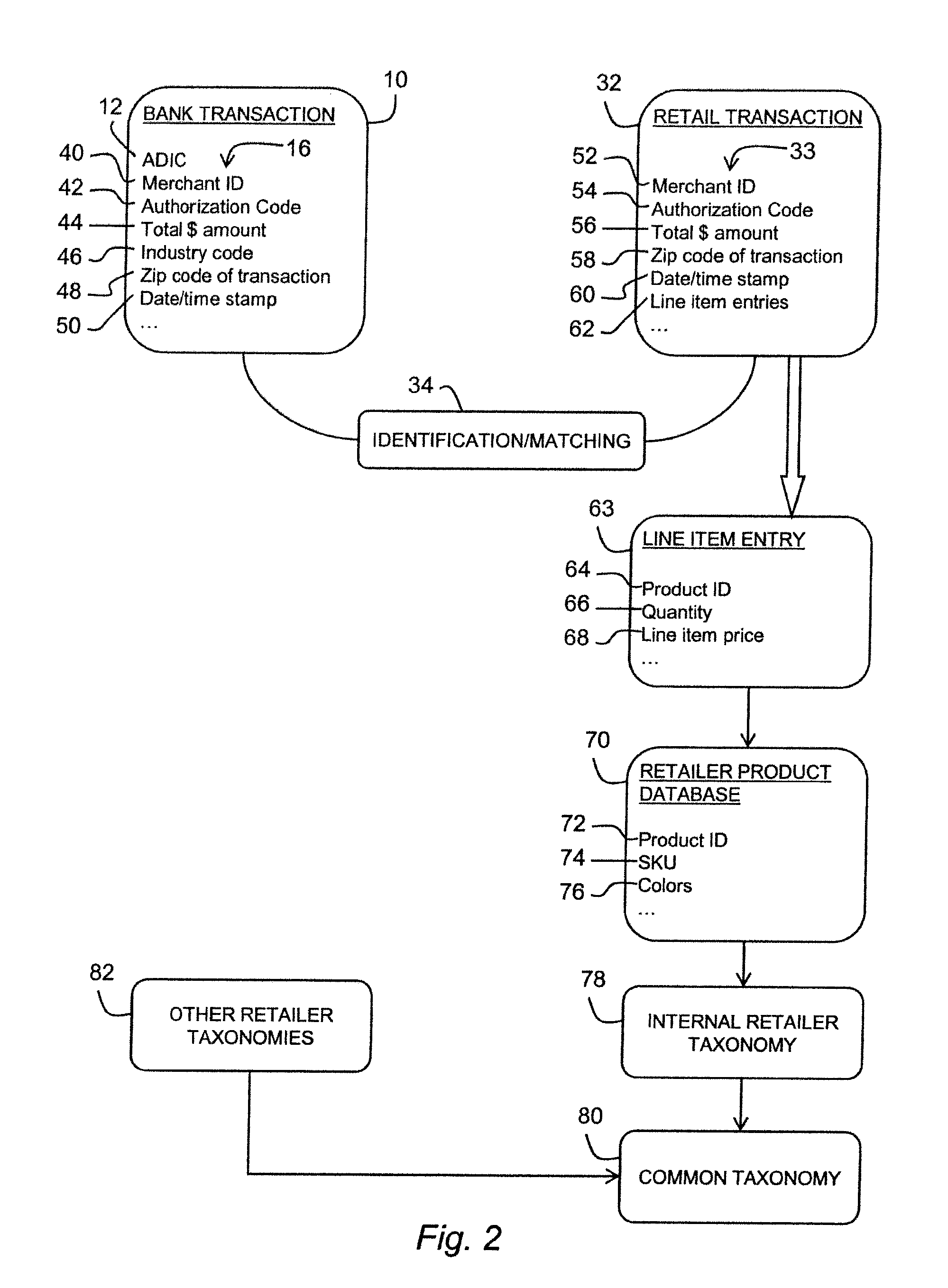

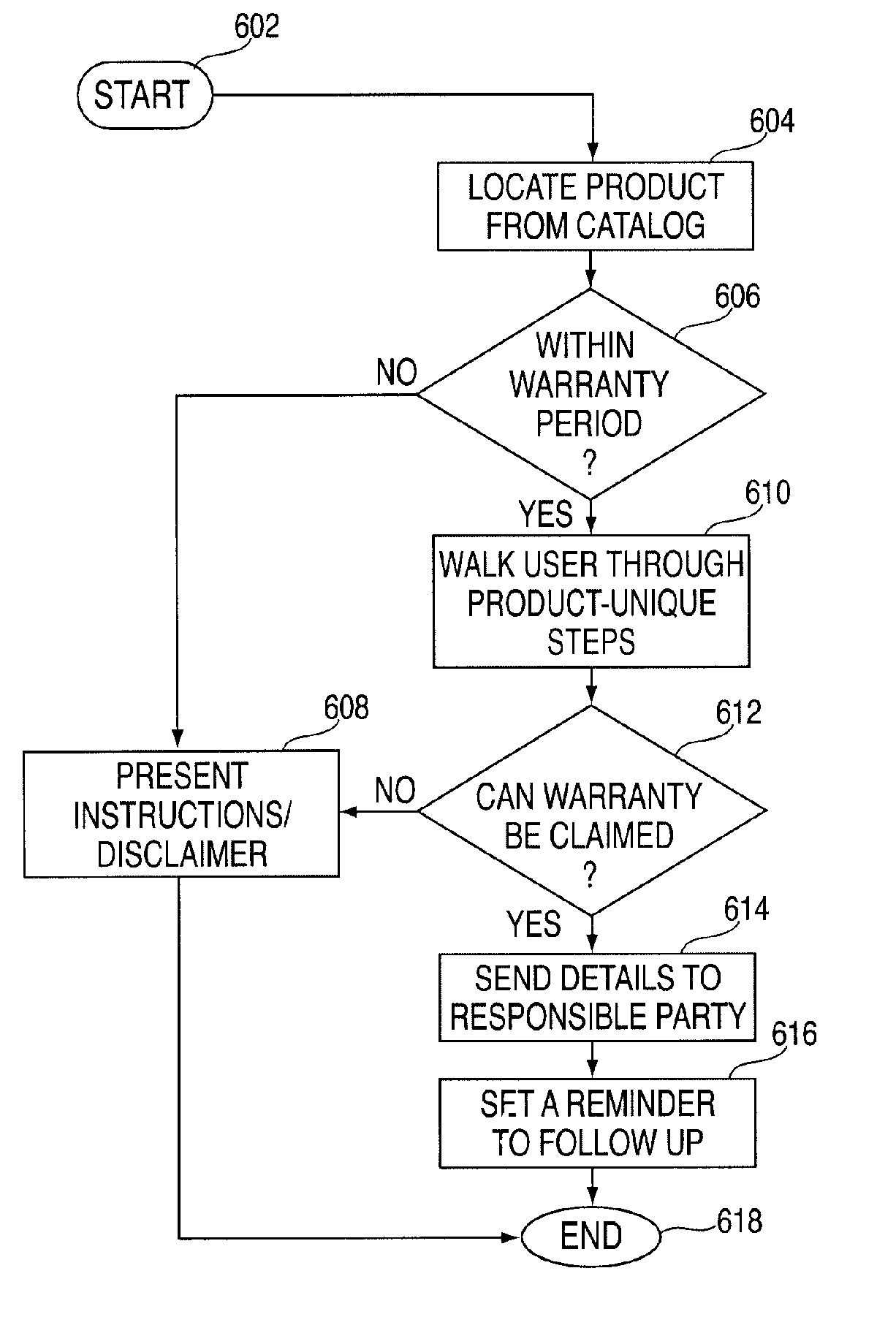

System and method for delivering a financial application to a prospective customer

A method of providing a personalized advertisement campaign includes receiving from a financial institution anonymized customer data associated with a plurality of customers of the financial institution, creating key lifestyle indicators, which describe customer attributes, from the anonymized customer data, delivering online a pre-advertisement to at least one selected customer of the plurality of customers, receiving a prospective unique customer identification code from the financial institution when at least one prospective customer accepts the pre-advertisement, matching the prospective unique customer identification code to at least one prospective customer of the plurality of customers, and delivering a financial application associated with the pre-advertisement to the at least one prospective customer with the matched prospective unique customer identification code.

Owner:SEGMINT INC

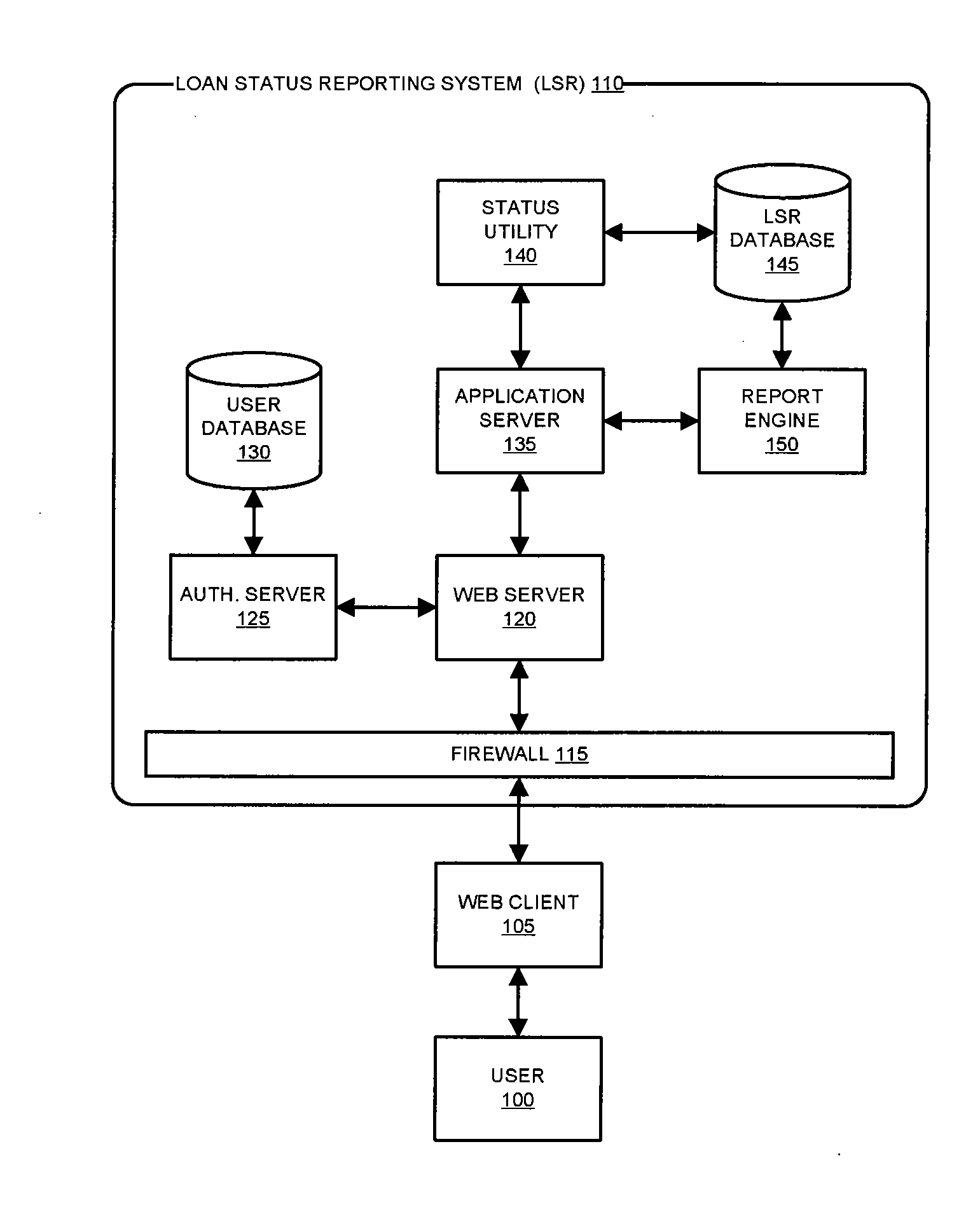

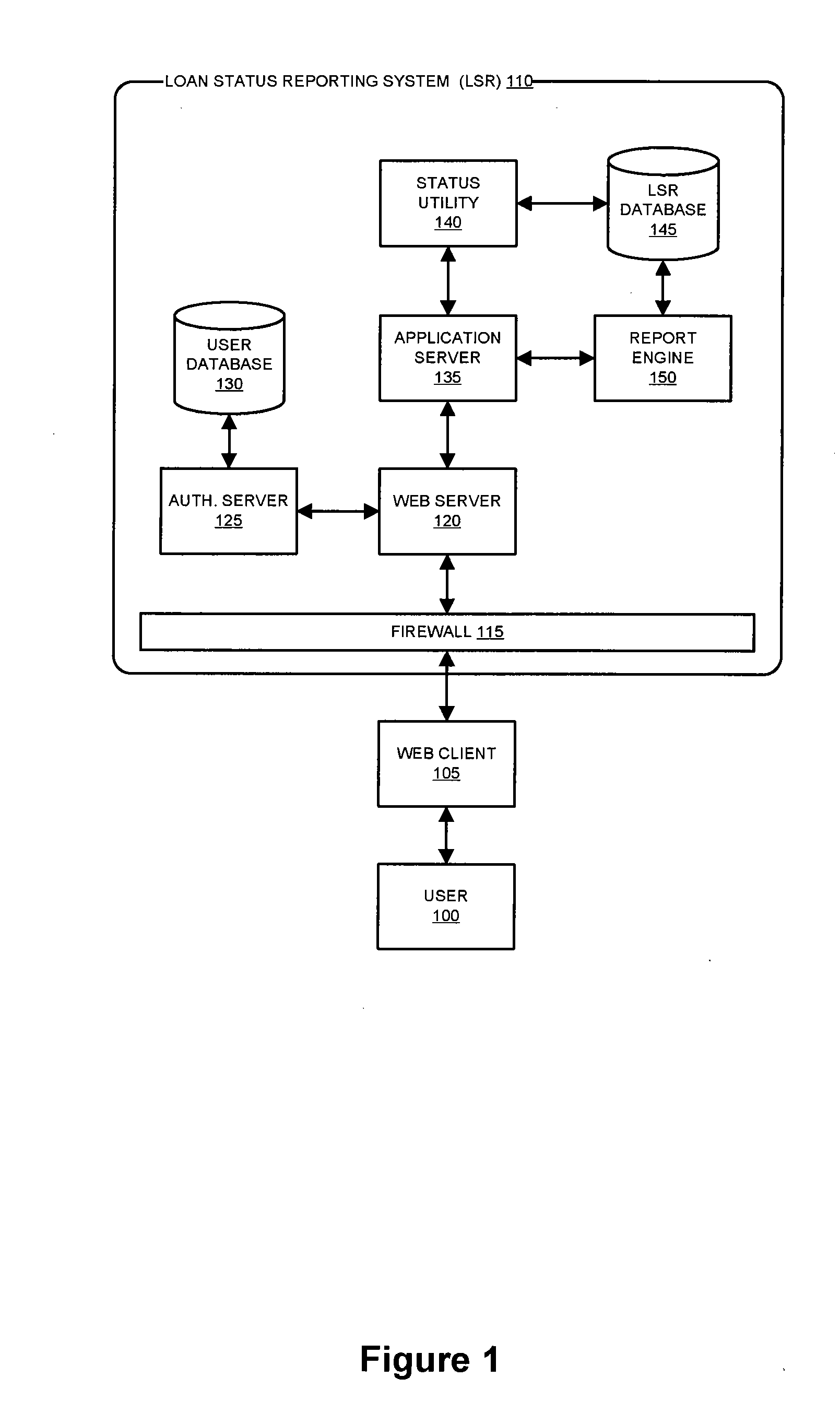

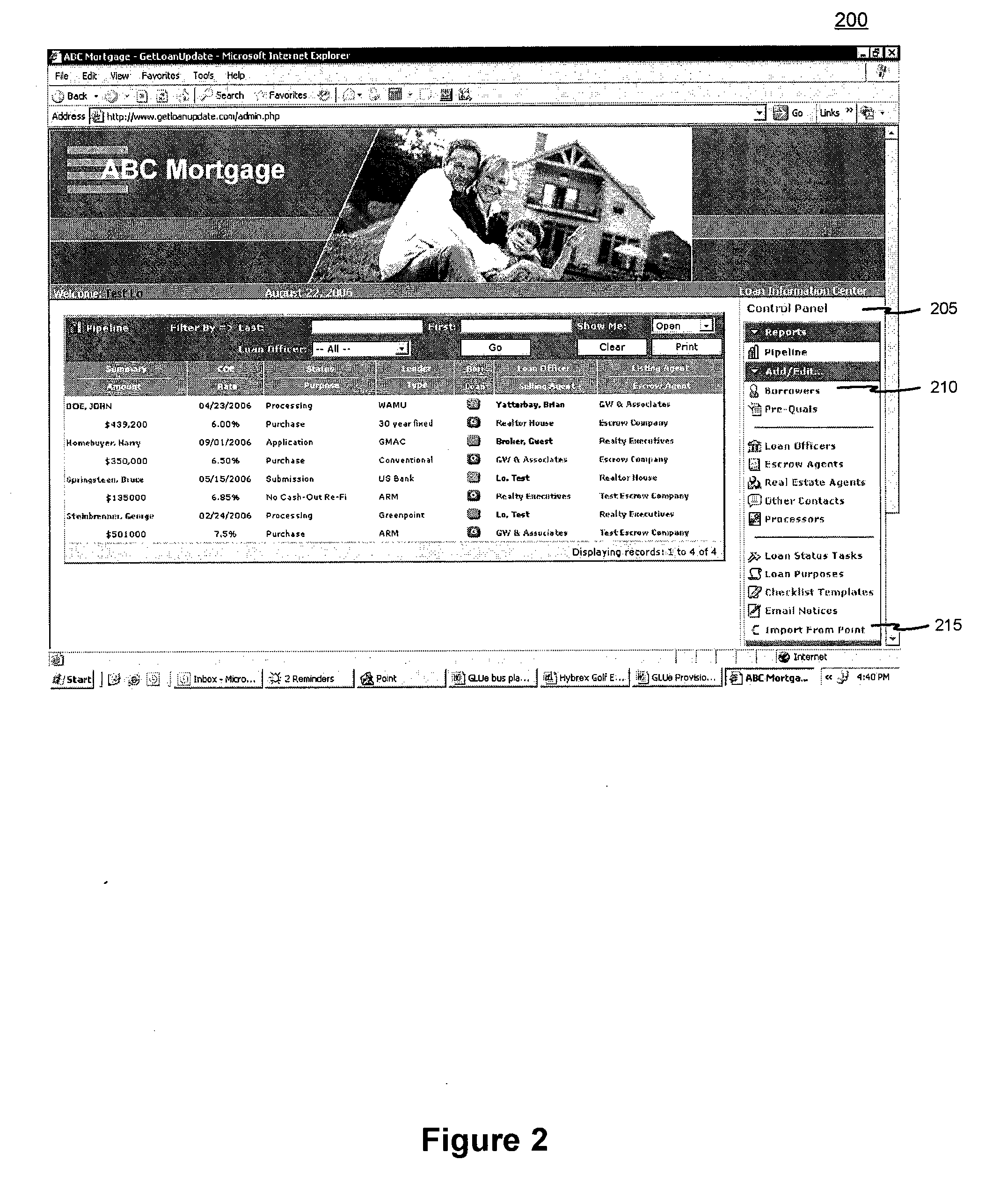

Loan status reporting system and method

A system and method is disclosed for managing and communicating the tasks required in business and financial application processing and for reporting real-time application status. The system enables those involved in application processing to create client data, import client data from another application or database, add a task template based on the type of loan a borrower is seeking, receive notifications when a task requires their attention, and update the status of a task. The system further enables a borrower or any other authorized third party, including realtors and title agents among others, to access and view the status of their loan application. A gallery interface enables the borrower or any other authorized third-party to view photos of a property that borrower is purchasing.

Owner:GET LOAN UPDATE

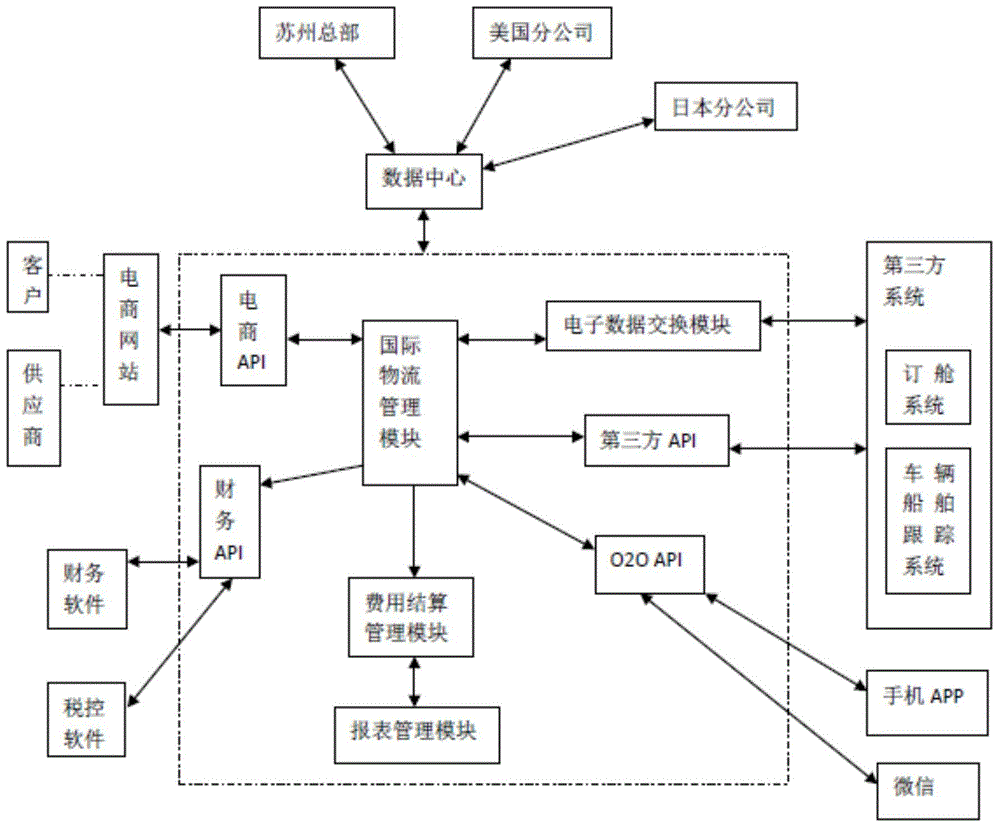

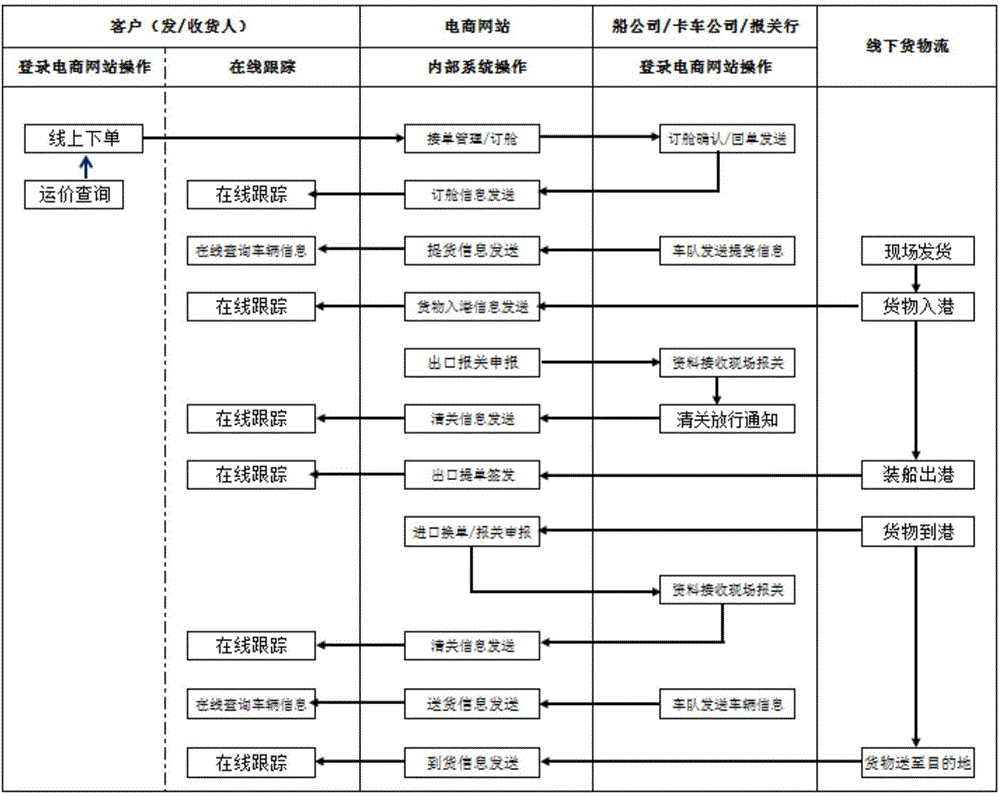

Application system of international logistics e-commerce platform based on Internet of Things (IoT) technology

InactiveCN106157081AAutomatic calculation of delivery timeAutomatically calculate delivery timeLogisticsMarketingThird partyLogistics management

The invention discloses an application system of an international logistics e-commerce platform based on IoT technology. The system comprises an integrated logistics management system, an electronic data exchange module, an e-commerce application program interface, an e-commerce website, a finance application program interface, an O2O application interface and a third-party application program interface. The system can realize real-time quotation, namely quotation can be provided once delivery address, weight and size information is input, and information including full container load or less than container load, pickup time, delivery time, shipping schedule and shipping companies is calculated automatically; an optimized scheme can be recommended; real-time quotations can be screened intelligently, and an optimal scheme is recommended to clients; and one-stop service is realized by door-to-door whole-course international logistics services are provided for senders and receivers needless of a third party or off line operation, and the cargo state can be tracked in the whole course.

Owner:金忠国

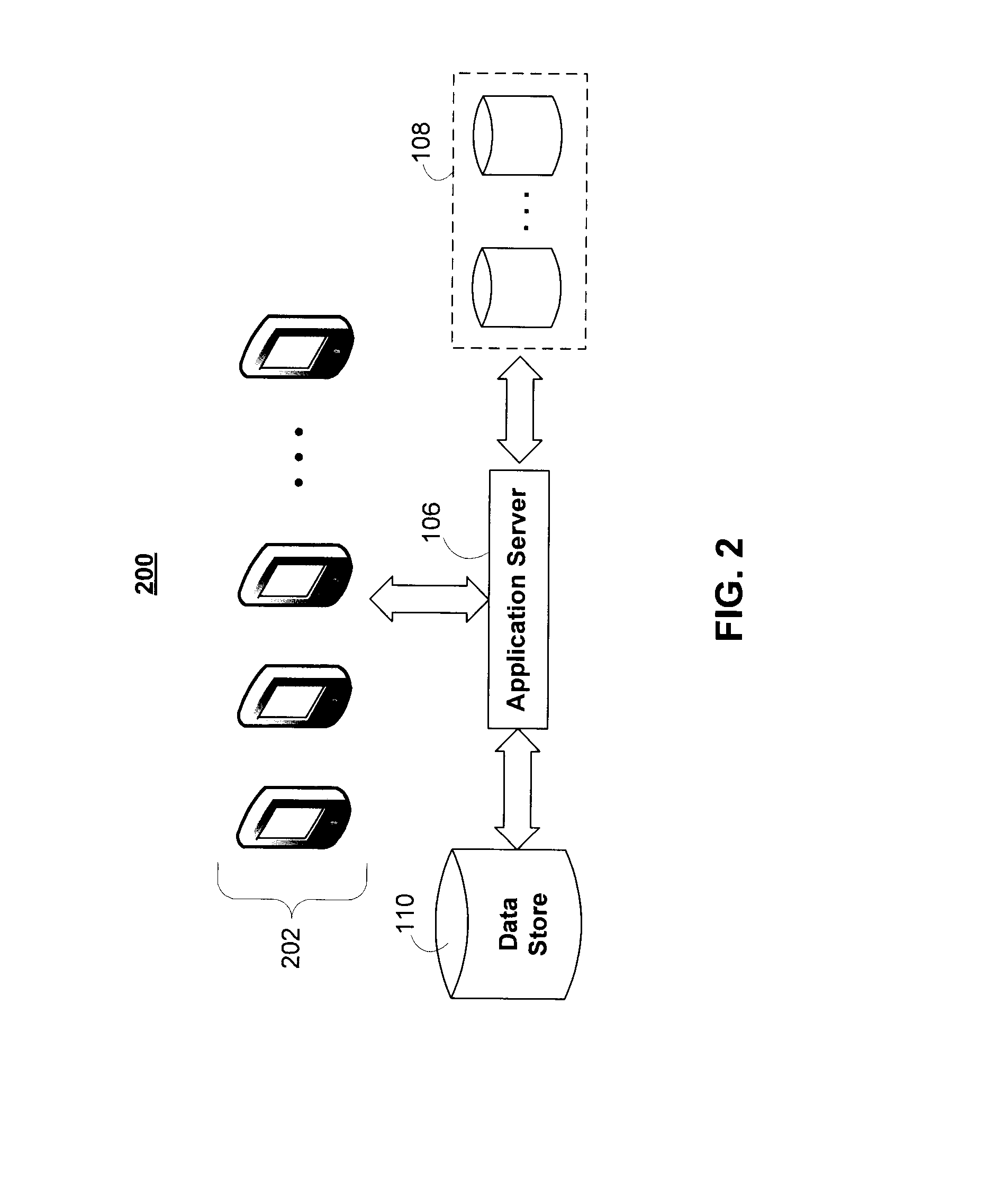

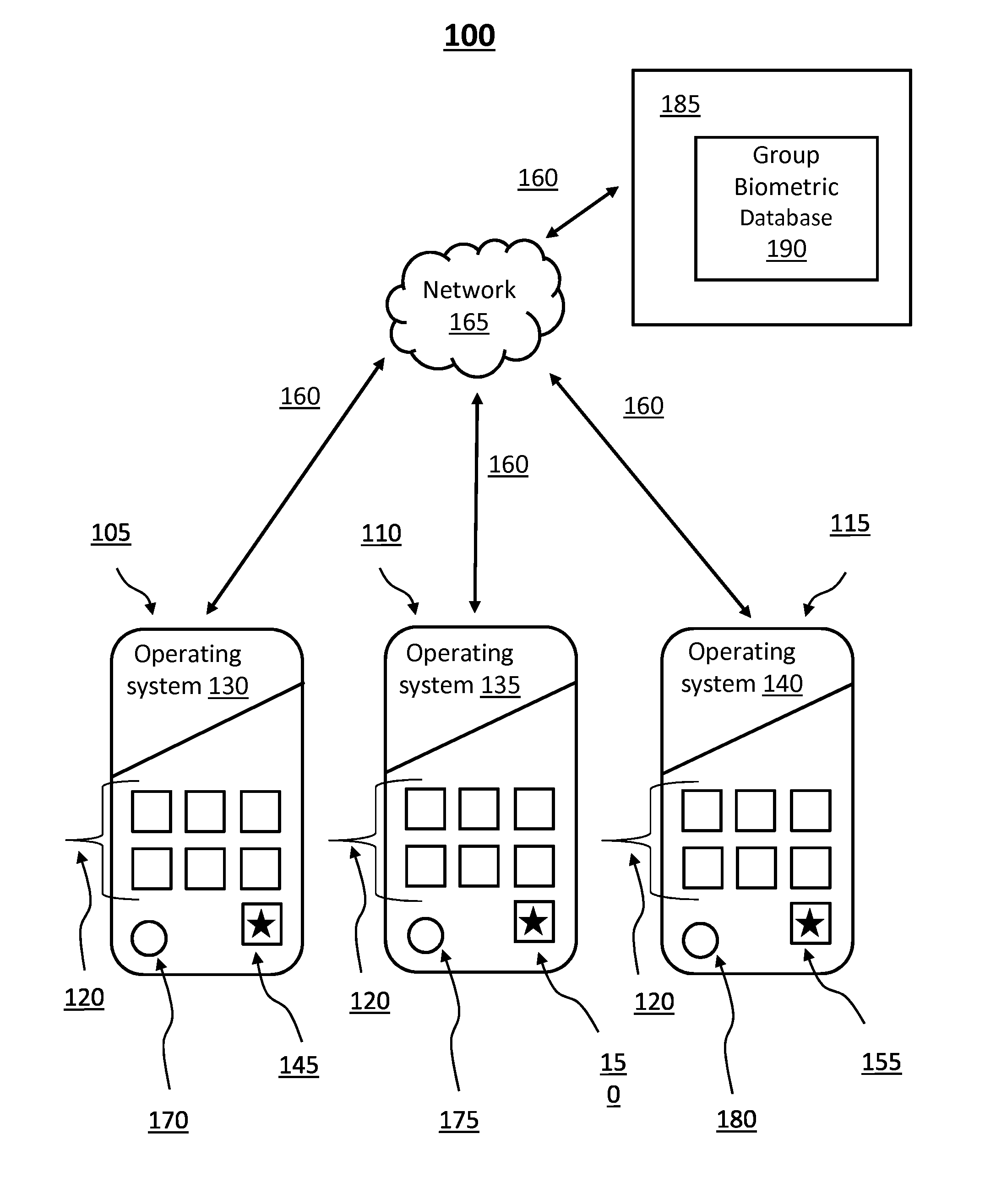

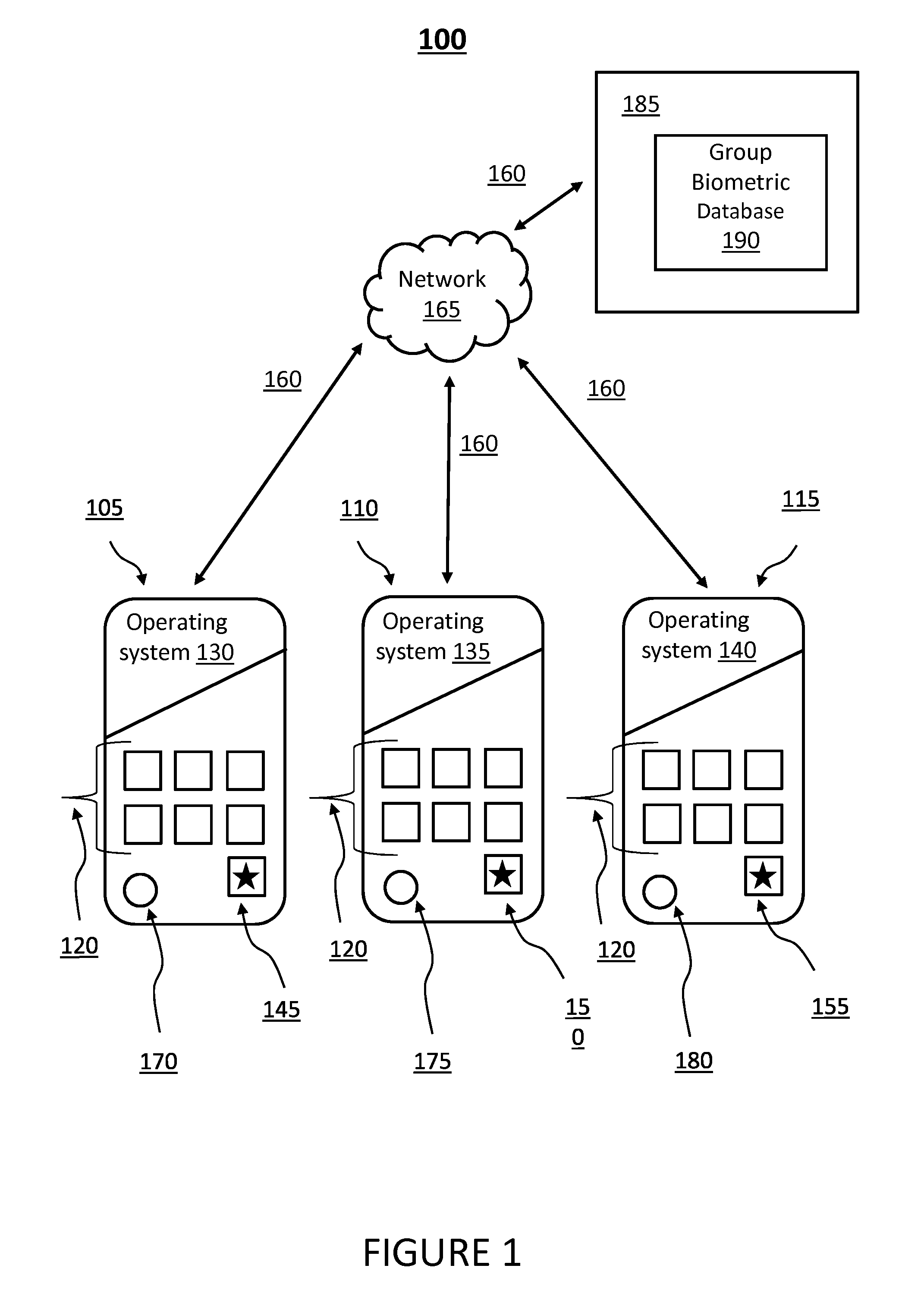

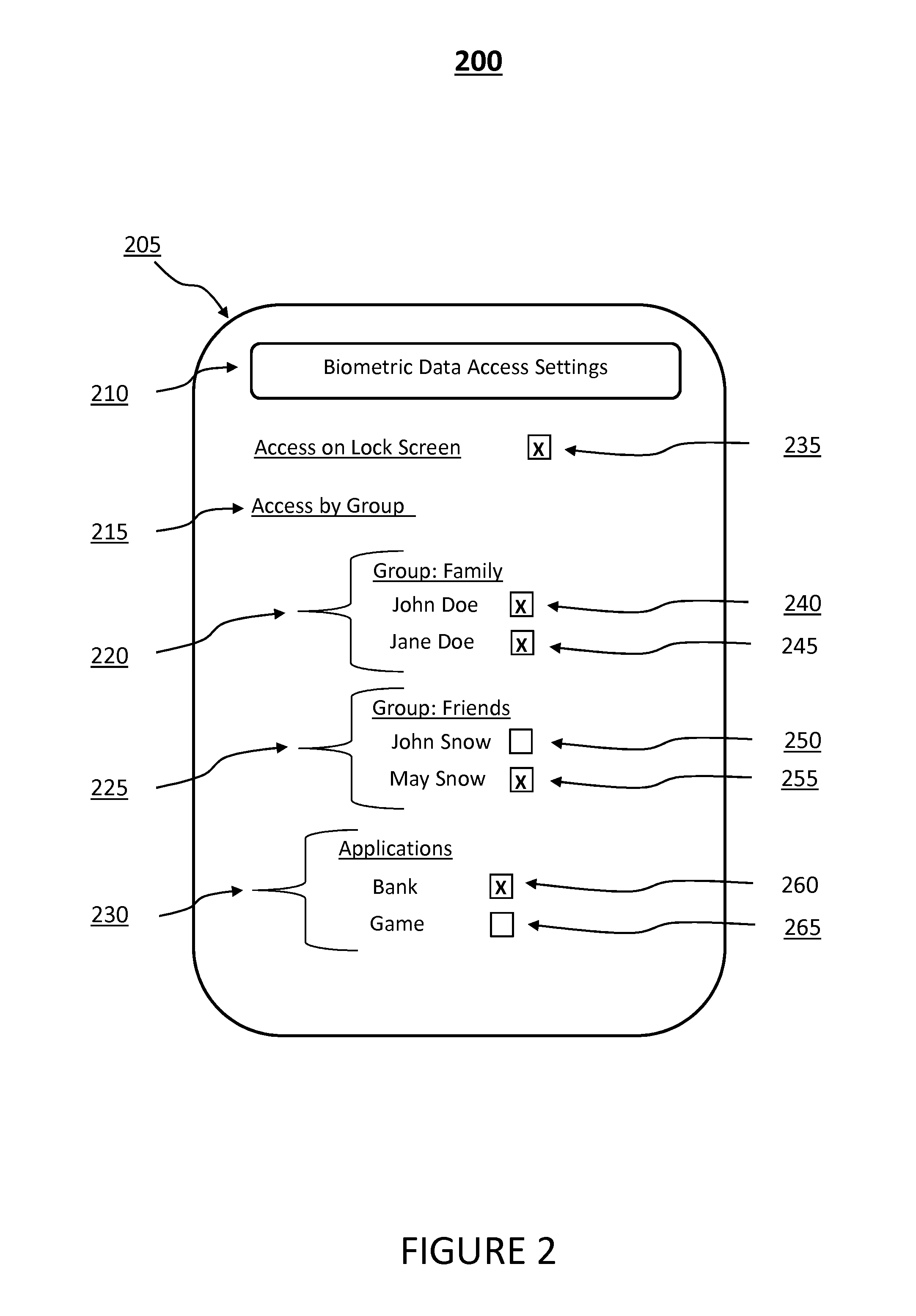

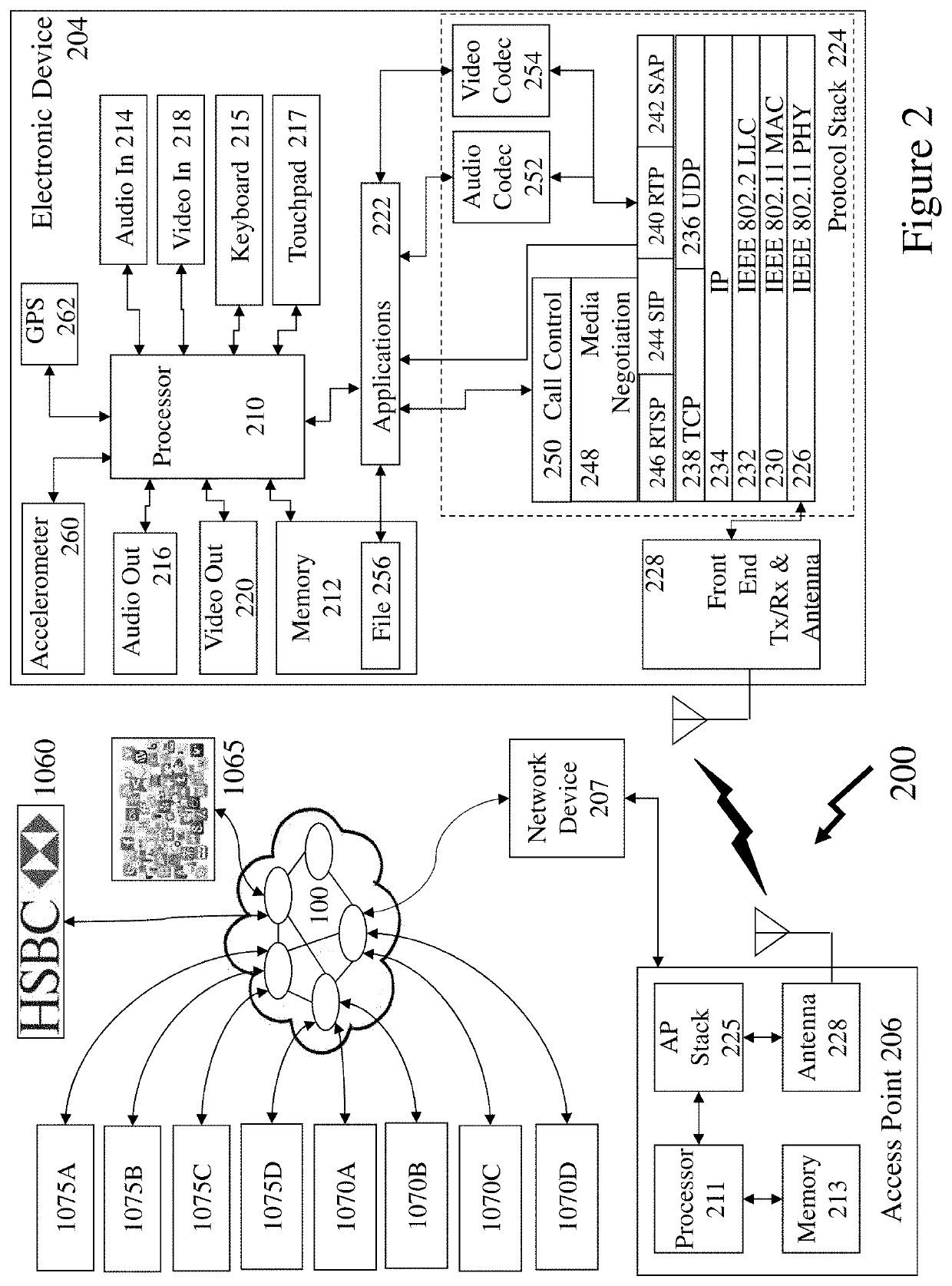

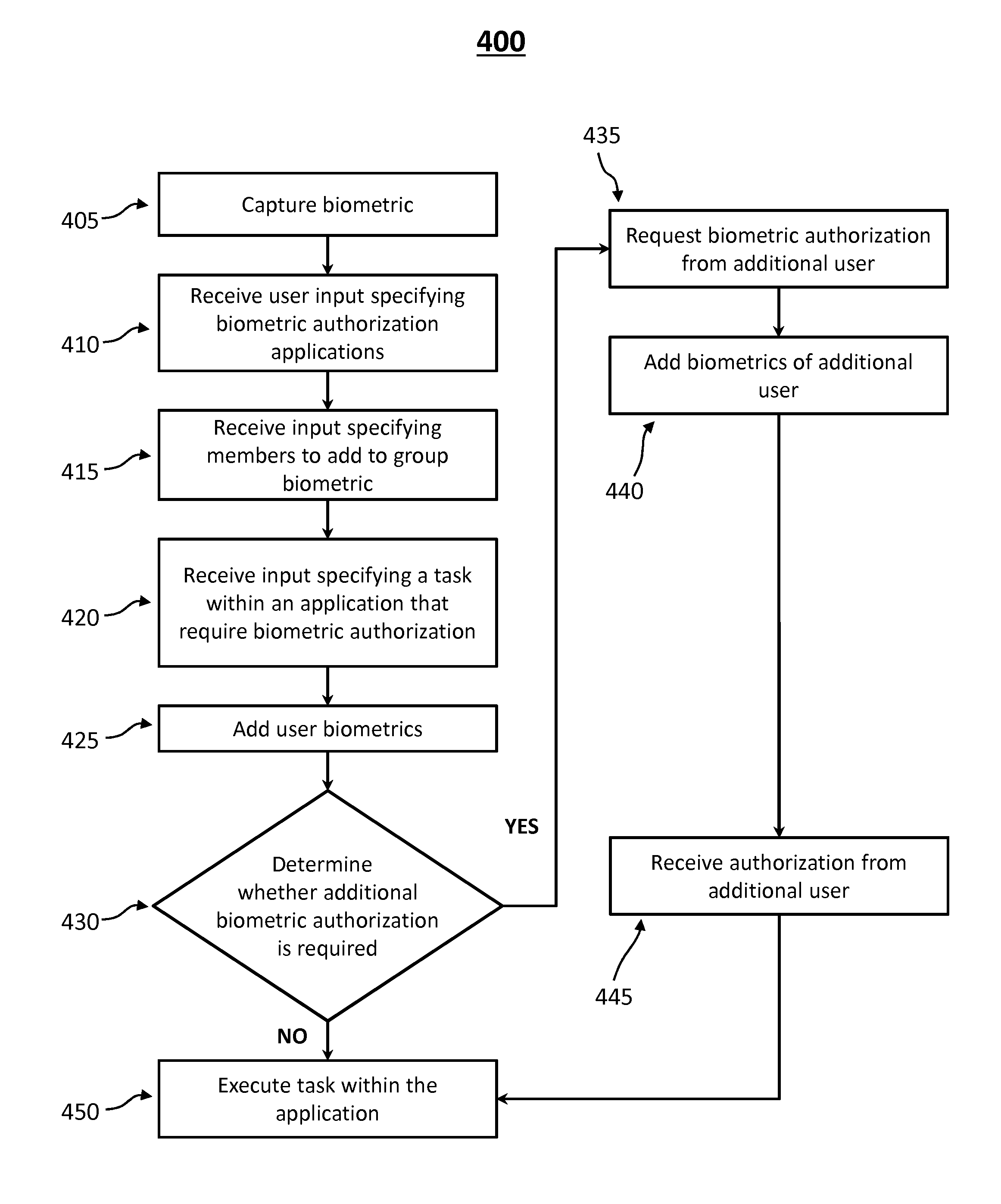

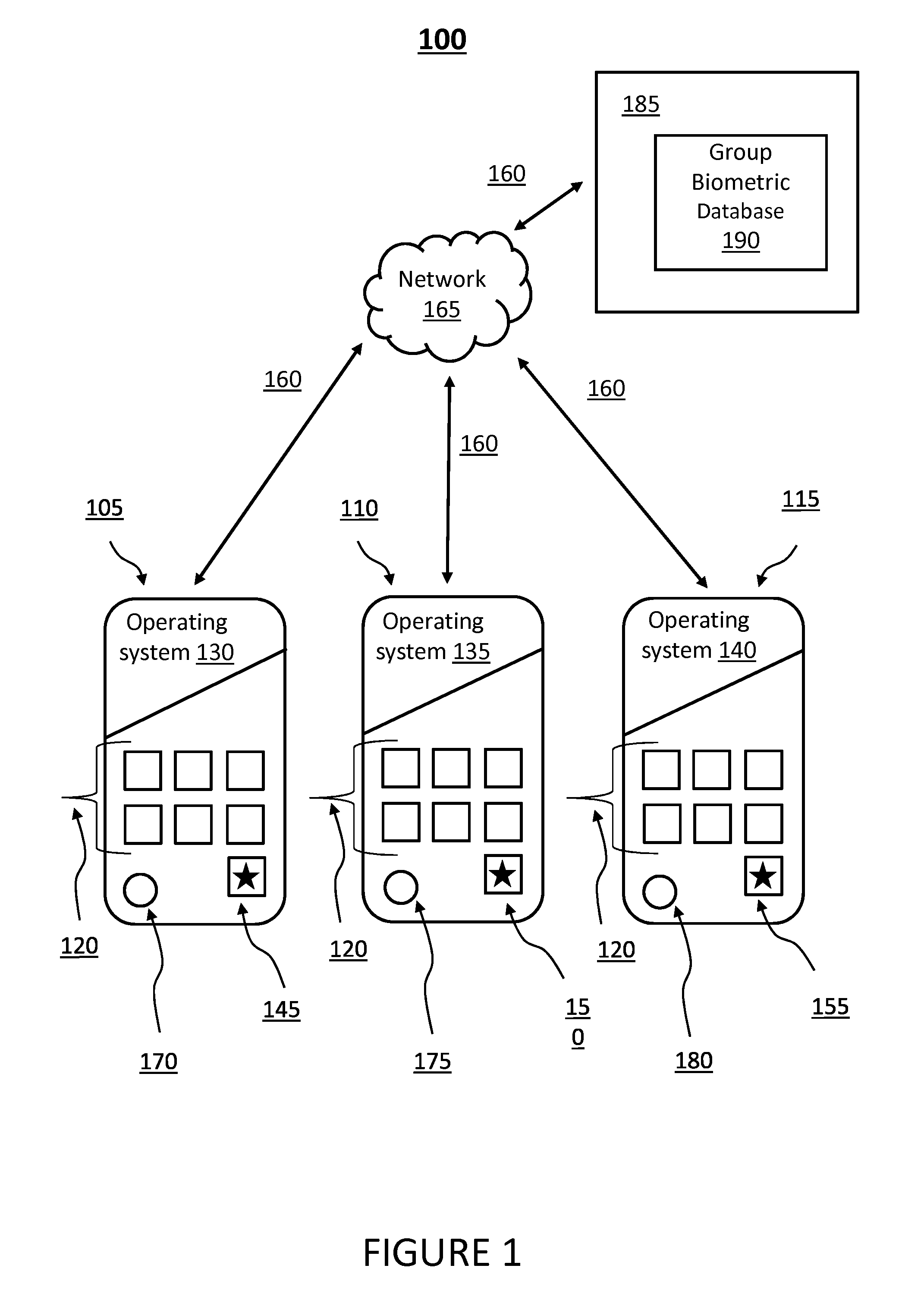

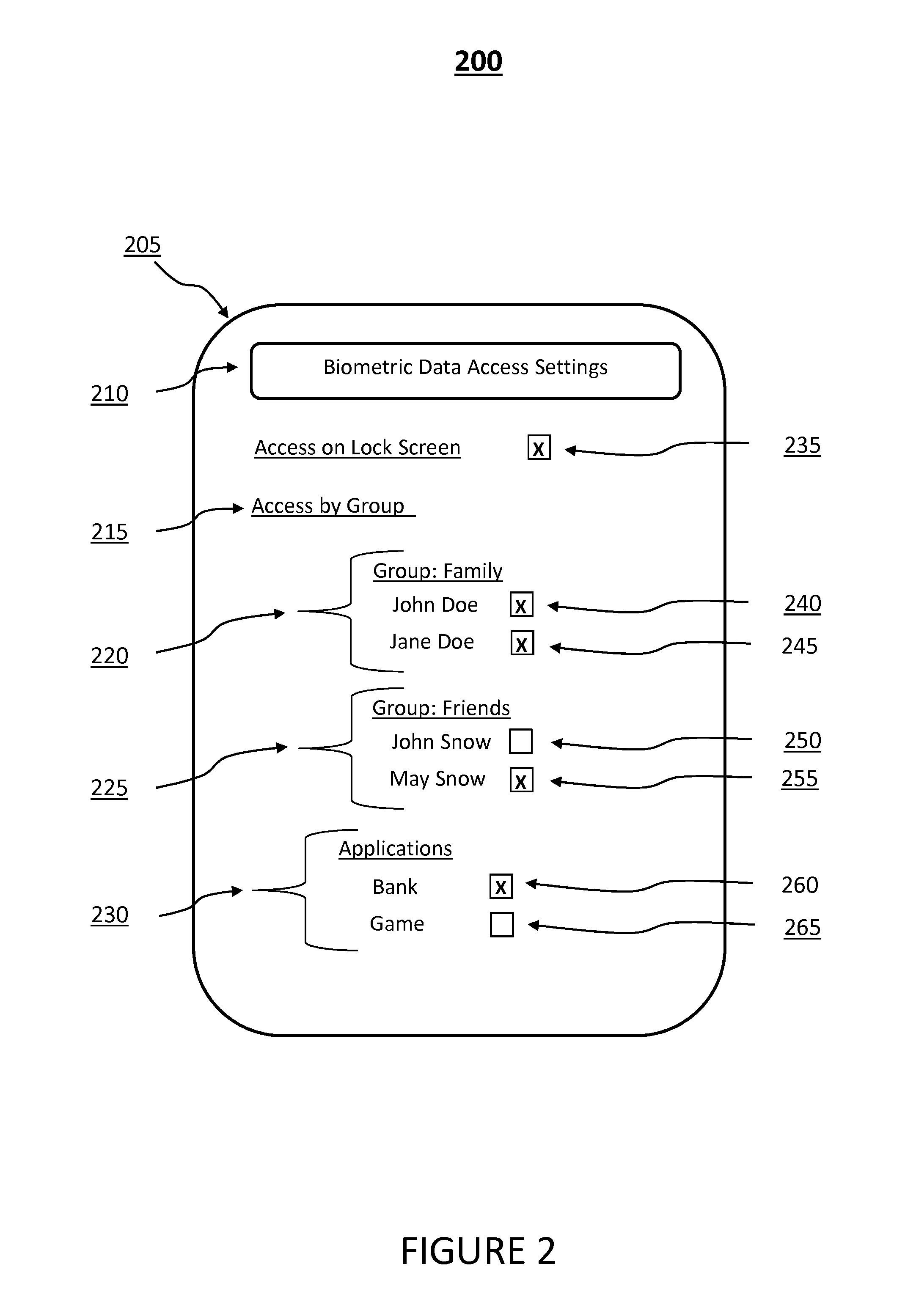

Community biometric authentication on a smartphone

ActiveUS20150358316A1Digital data processing detailsMultiple digital computer combinationsBiometric dataUser device

Methods and systems are presented for performing biometric authentication of a plurality of users on a user device (e.g., smartphone). In some embodiments, a user may specify in biometric settings certain biometric authentication applications to be used with a group biometric authentication system. A user may additionally specify in biometric settings other users to add to a biometric authentication group. A user may perform functions or access data in biometric authentication-enabled applications (e.g., a financial application) that require the biometric authentication of one or more other users by transmitting a request to the user device of the one or more other users for the required biometric data (e.g., a fingerprint scan).

Owner:GRANDIOS TECH LLC

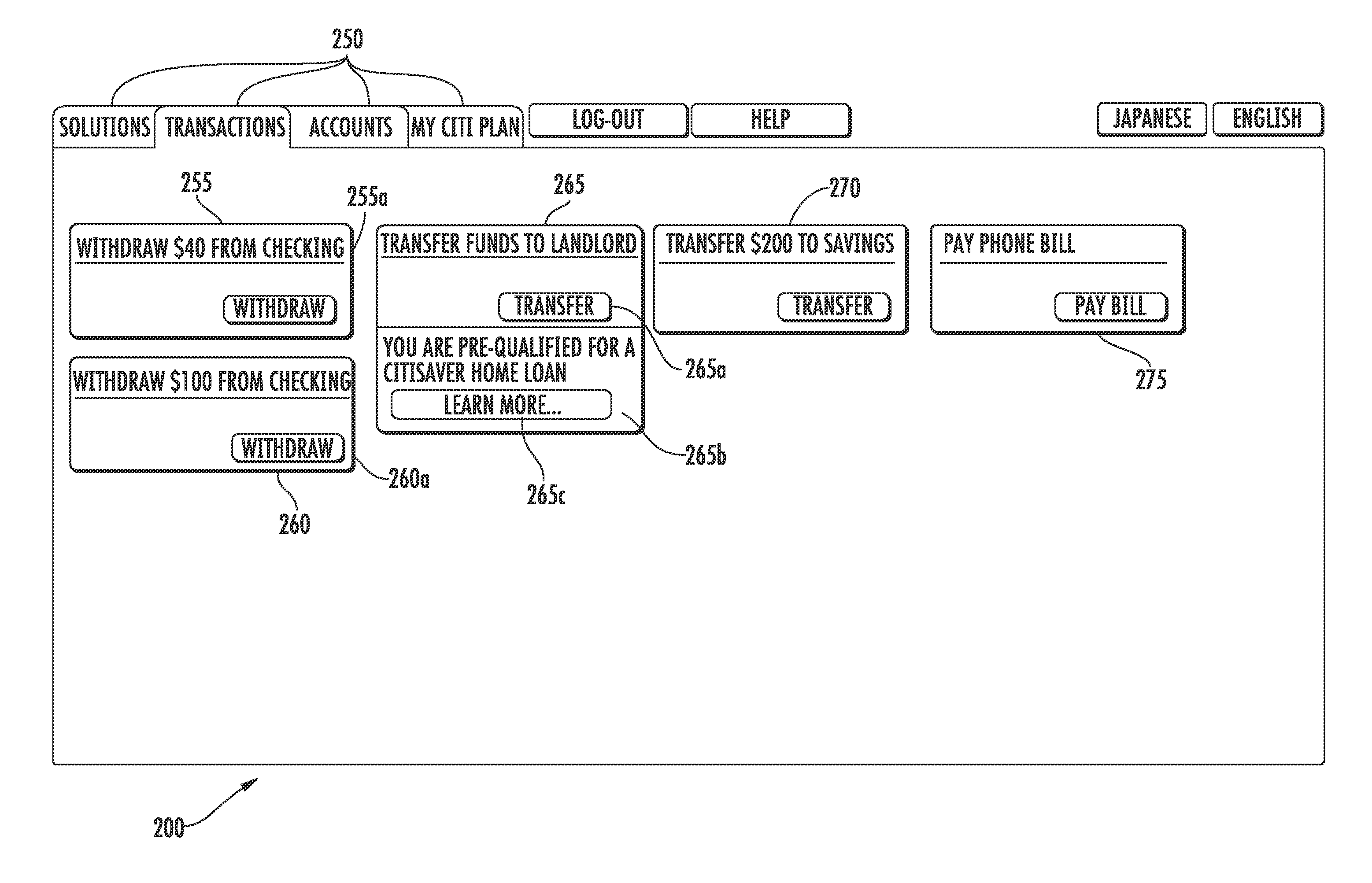

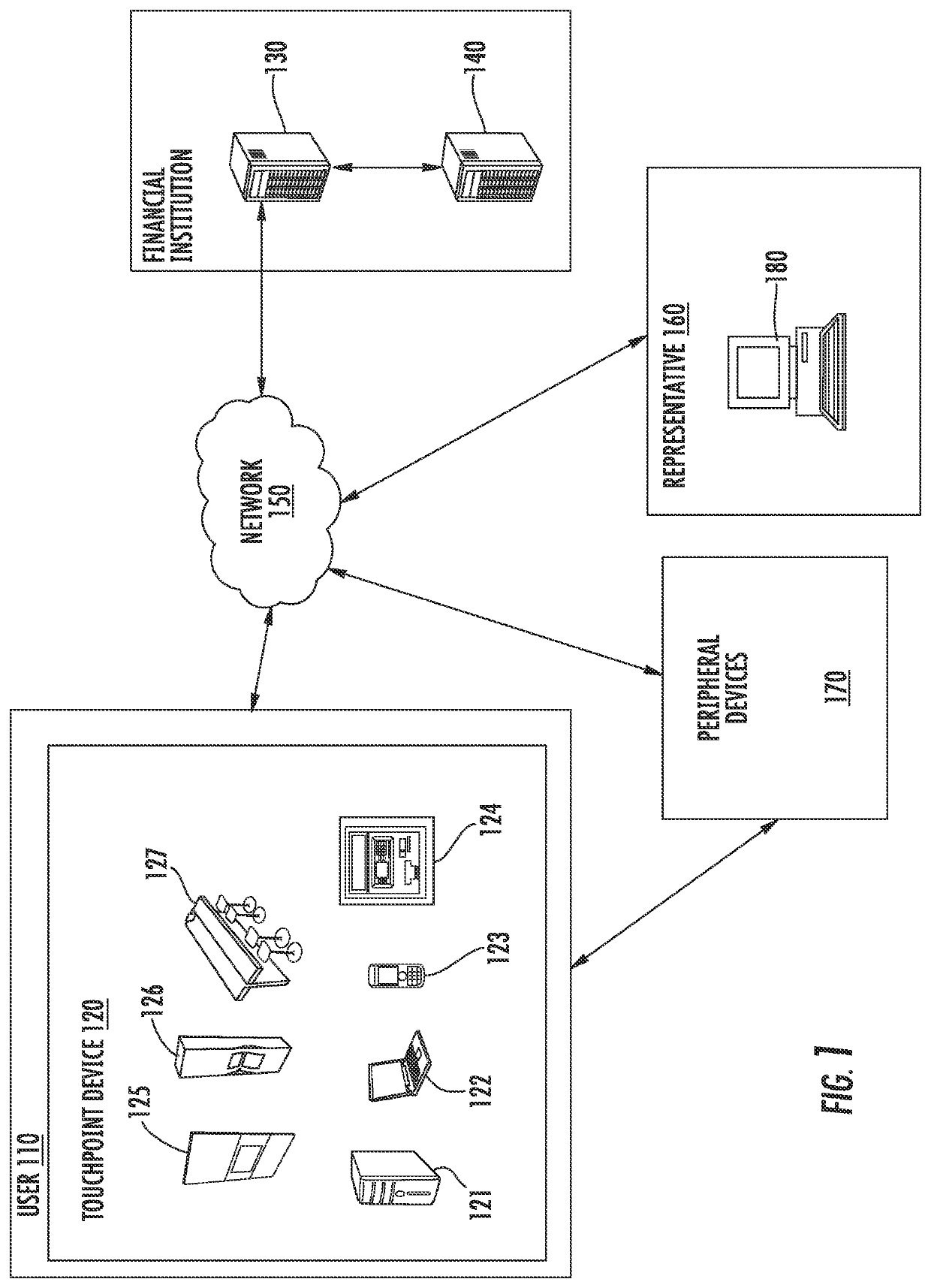

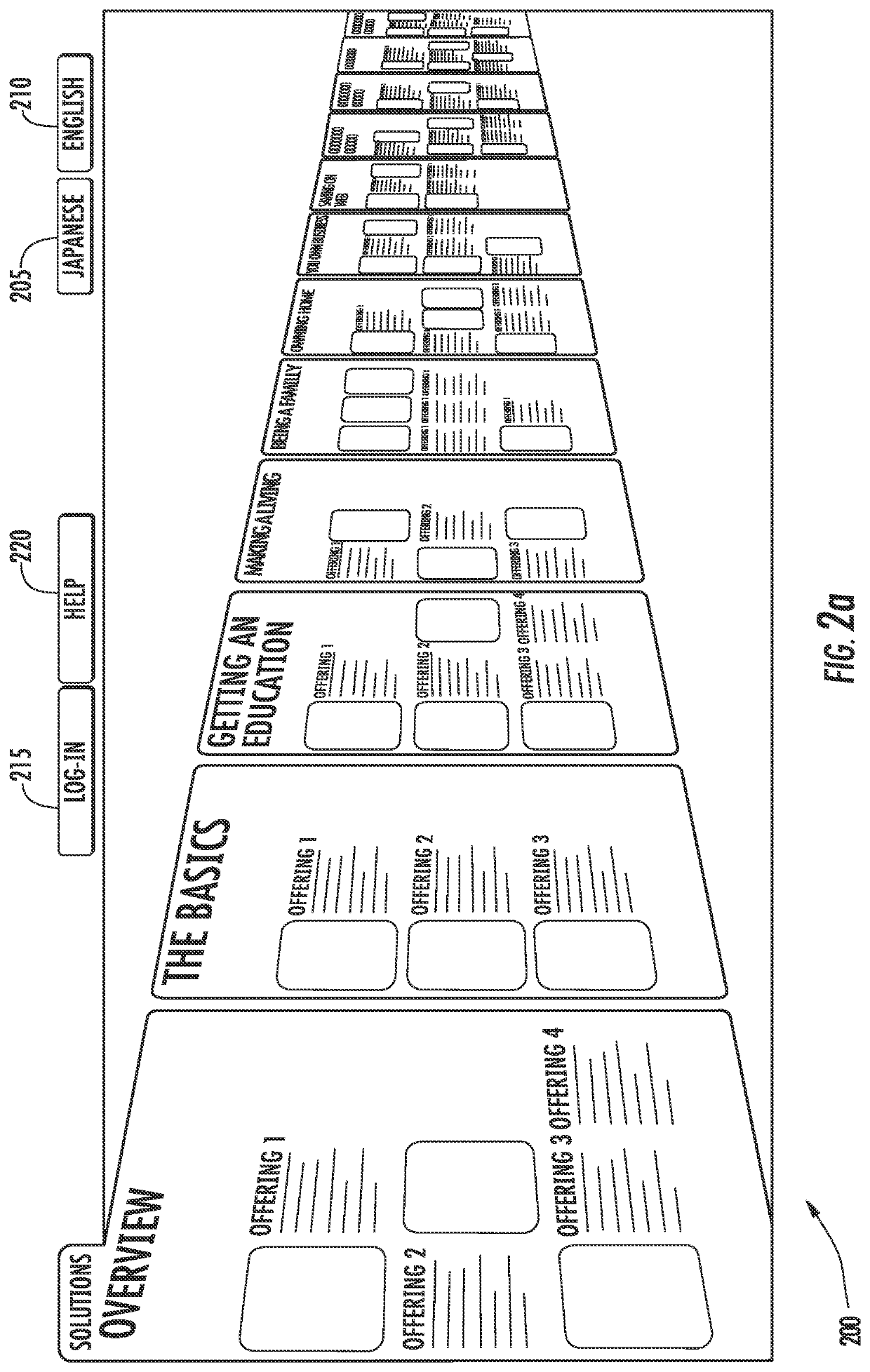

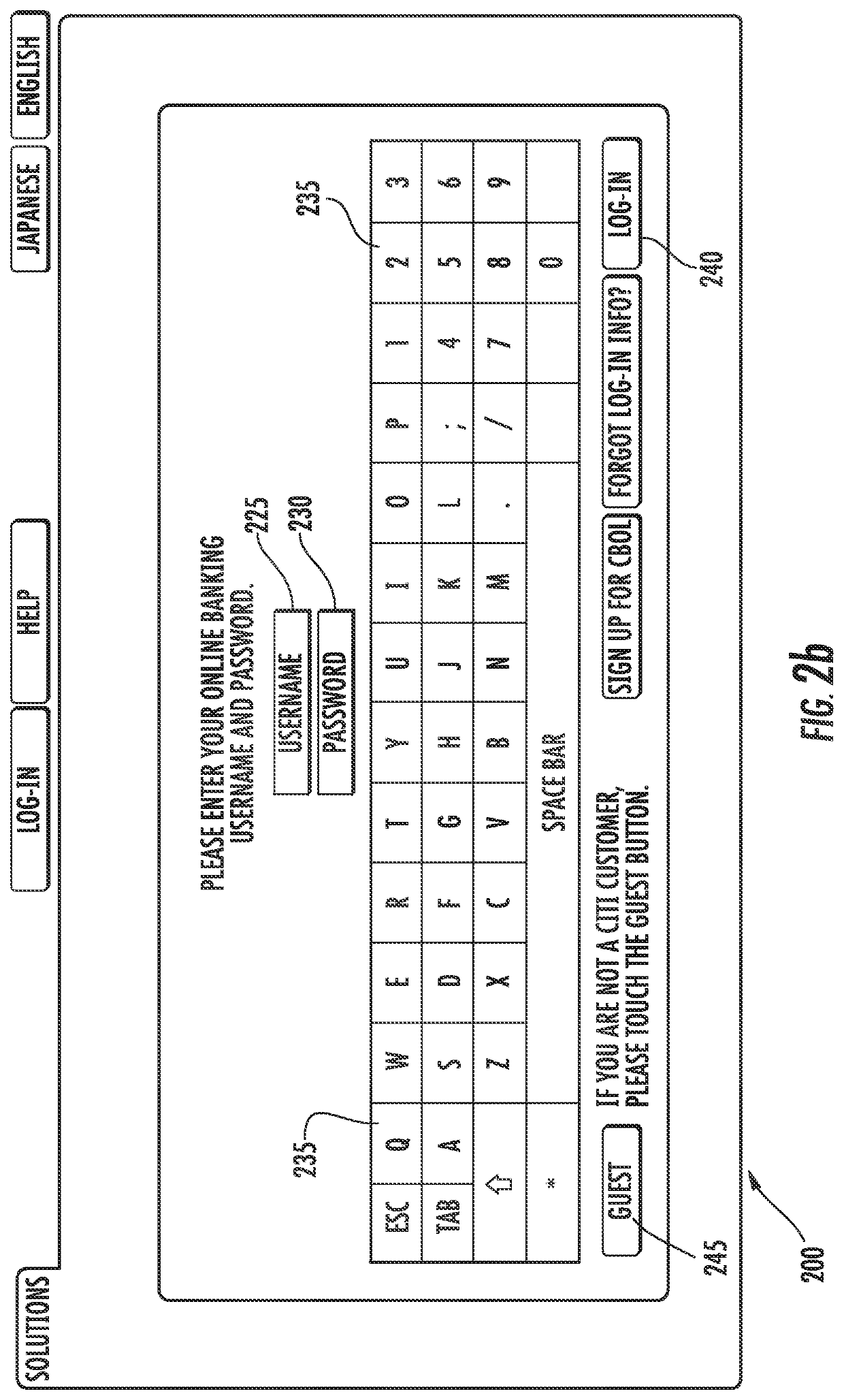

System and Method for Customizing Real-Time Applications On A User Interface

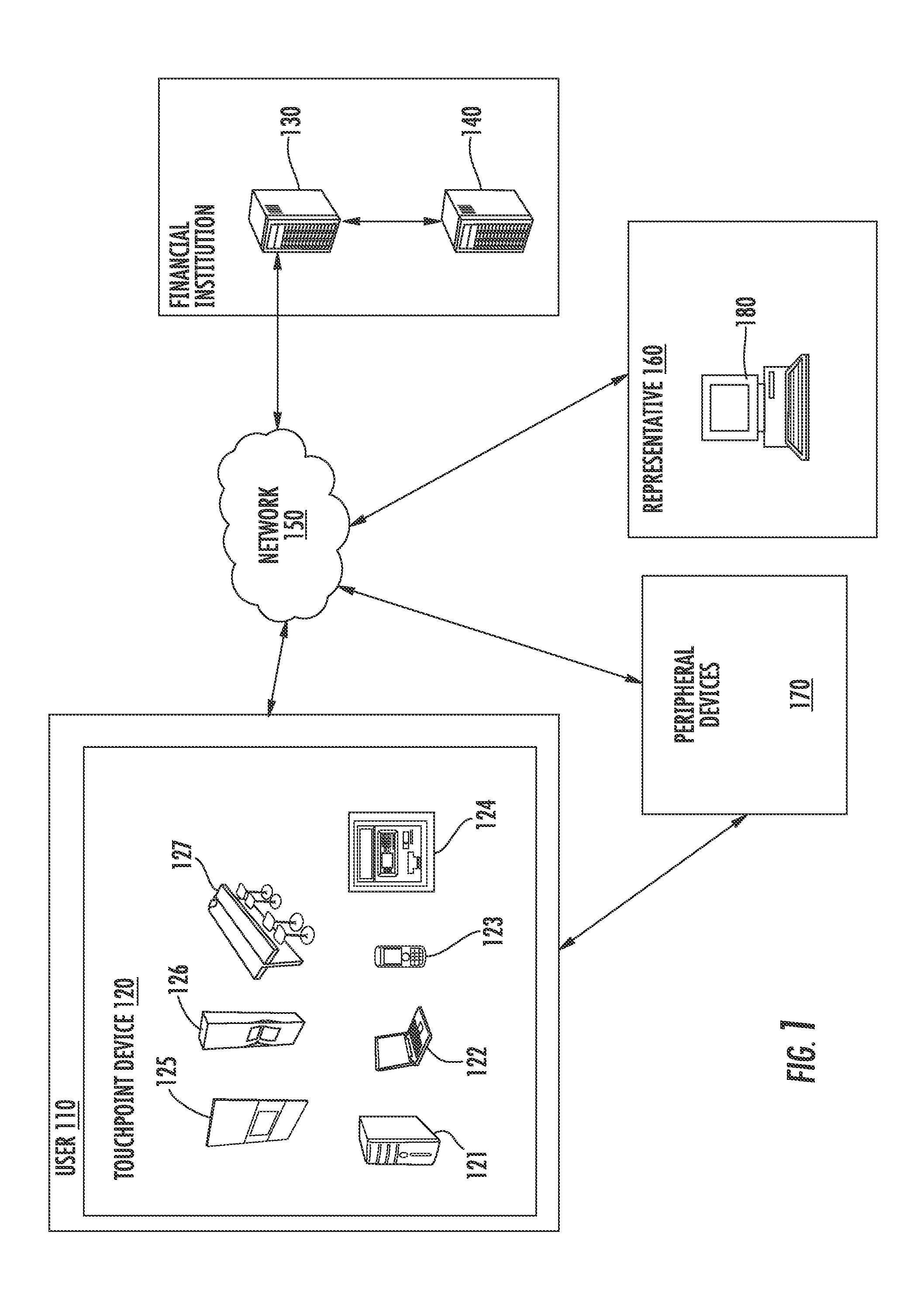

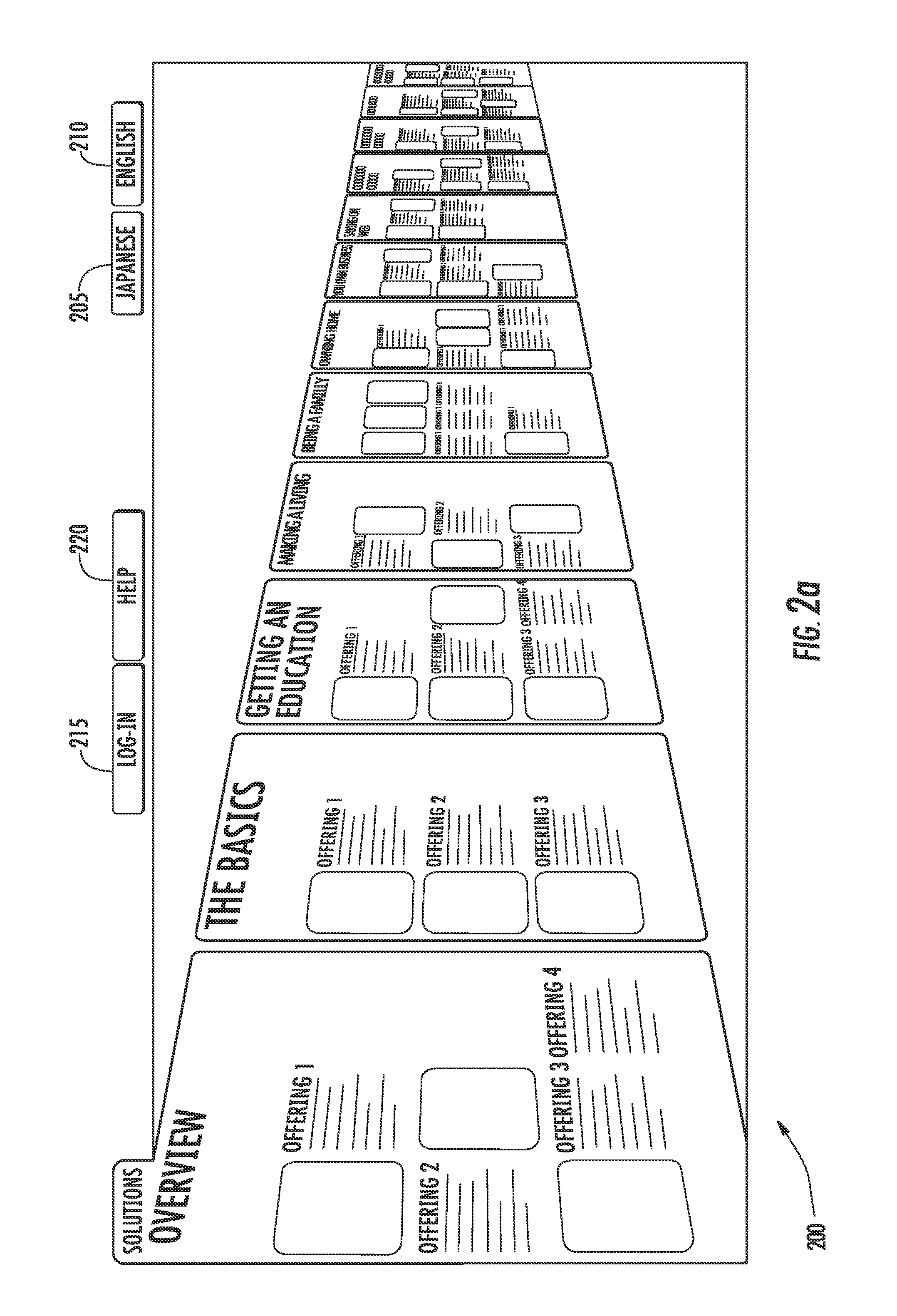

A computer-implemented method for customizing a user interface comprises receiving, from a touchpoint device, identification information entered by a user; accessing a record of the user from a database using the received identification information; determining whether the record has any application windows configured for the user interface on the touchpoint device; transmitting, by a server to the touchpoint device, at least a first financial application window and a second financial application window identified by the record of the user for display of the first financial application window and the second financial application window simultaneously on the user interface of the touchpoint device; receiving instructions from the user via the first financial application window to perform a financial transaction; and performing, by a server, the financial transaction while the touchpoint device displays at least the first financial application window and the second financial application window, wherein the first financial application window and the second financial application window are updated with real-time information.

Owner:CITIBANK

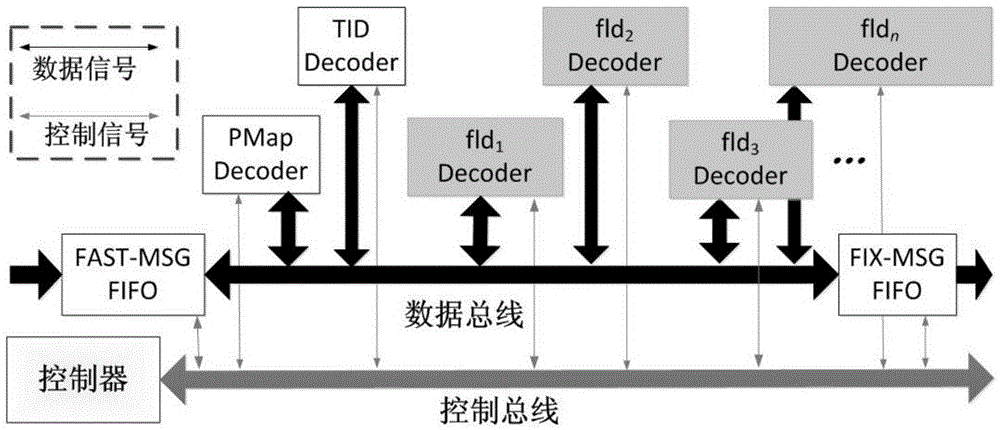

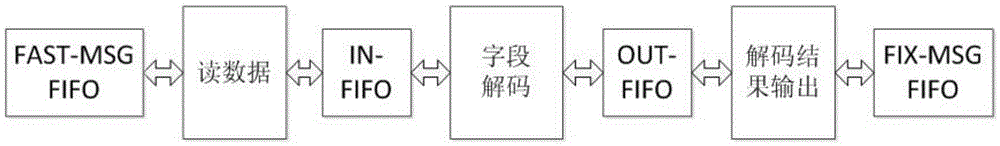

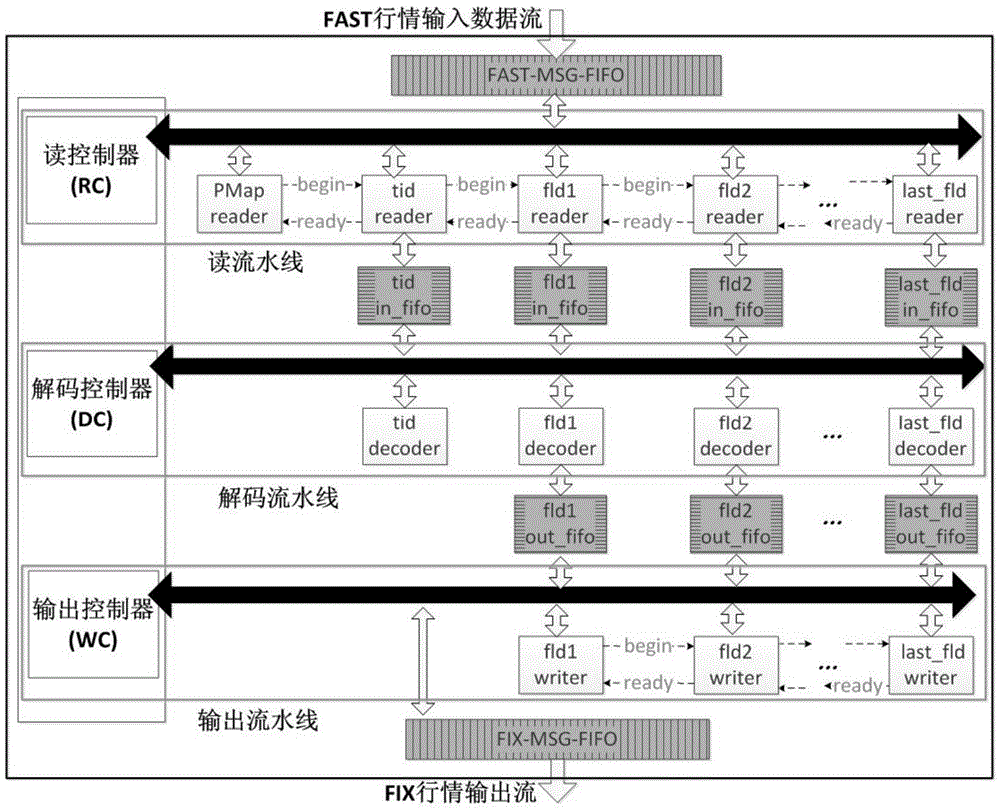

Pipeline architecture-based low-latency FAST quotation decoding device and method

ActiveCN105654383ASlow processingAvoid processing delaysFinanceElectric digital data processingThree stageLatency (engineering)

The invention relates to a pipeline architecture-based low-latency FAST quotation decoding device and method. The device comprises internal buses, a controller, and field decoding operators in each of all the fields of FAST quotation data. The field decoding operators are respectively connected with the internal buses. Under the control of the controller, each filed of the FAST quotation data can be successively decoded. The internal buses are composed of a data bus and a control bus. By means of the data bus, the FAST quotation data are inputted into a stream buffer and the data transmission between the field decoding operators and an FIX message buffer is enabled. The control bus is responsible for the decoding operation of each field. The field decoding operators are in the form of three-stage decoding operators. Meanwhile, the streamlined type FAST quotation decoding process is realized based on the bus connection. According to the technical scheme of the invention, the quotation decoding speed is effectively accelerated. Meanwhile, the invention provides a support for the financial applications of algorithmic trading, high-frequency trading, market risk monitoring and the like.

Owner:INST OF INFORMATION ENG CAS

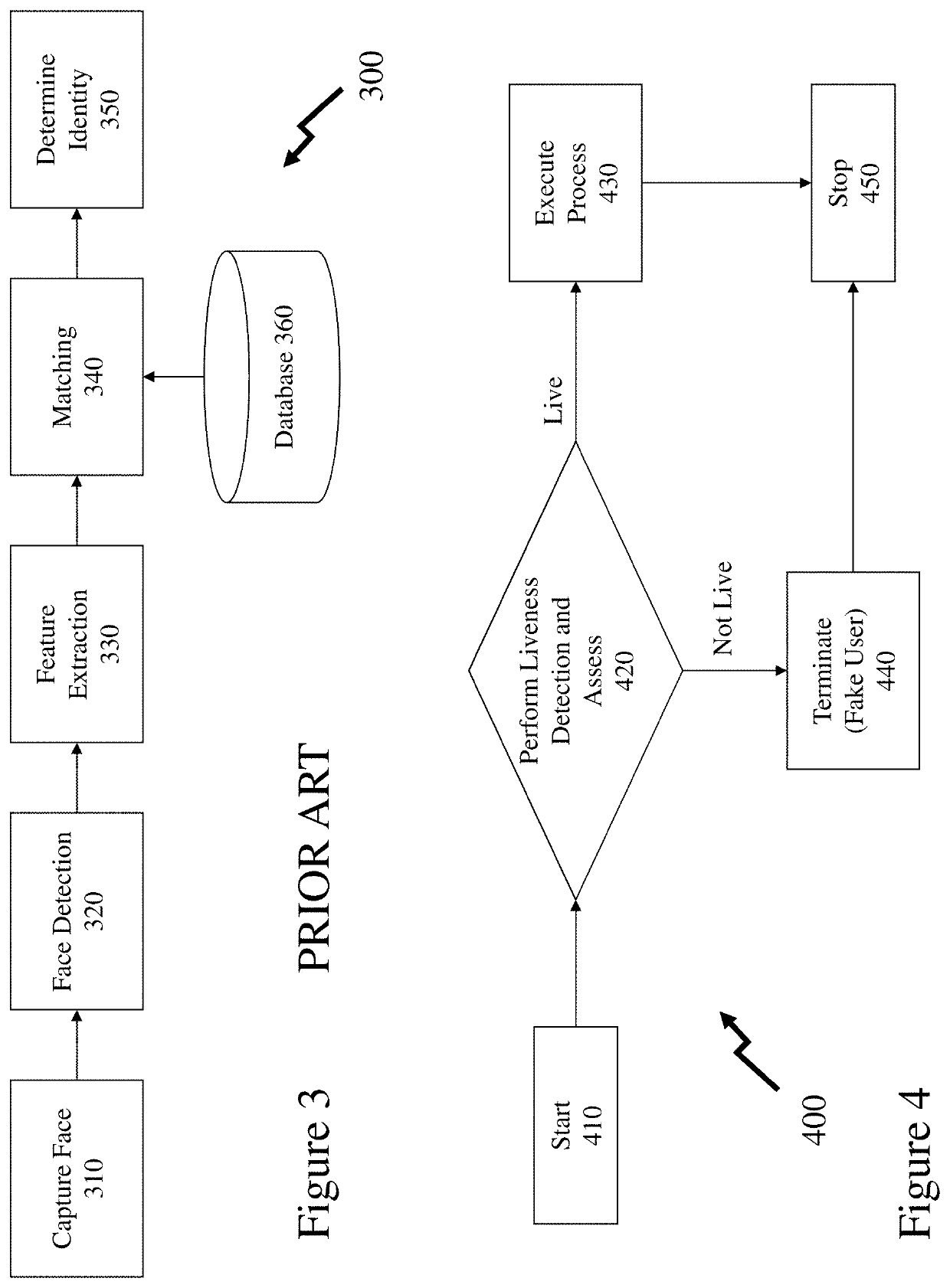

Liveness detection

ActiveUS20190377963A1Reduce restrictionsAcquiring/recognising eyesDigital data authenticationBiometric dataVerification system

Biometrics are increasingly used to provide authentication and / or verification of a user in many security and financial applications for example. However, “spoof attacks” through presentation of biometric artefacts that are “false” allow attackers to fool these biometric verification systems. Accordingly, it would be beneficial to further differentiate the acquired biometric characteristics into feature spaces relating to live and non-living biometrics to prevent non-living biometric credentials triggering biometric verification. The inventors have established a variety of “liveness” detection methodologies which can block either low complexity spoofs or more advanced spoofs. Such techniques may provide for monitoring of responses to challenges discretely or in combination with additional aspects such as the timing of user's responses, depth detection within acquired images, comparison of other images from other cameras with database data etc.

Owner:HAMID LAURENCE +1

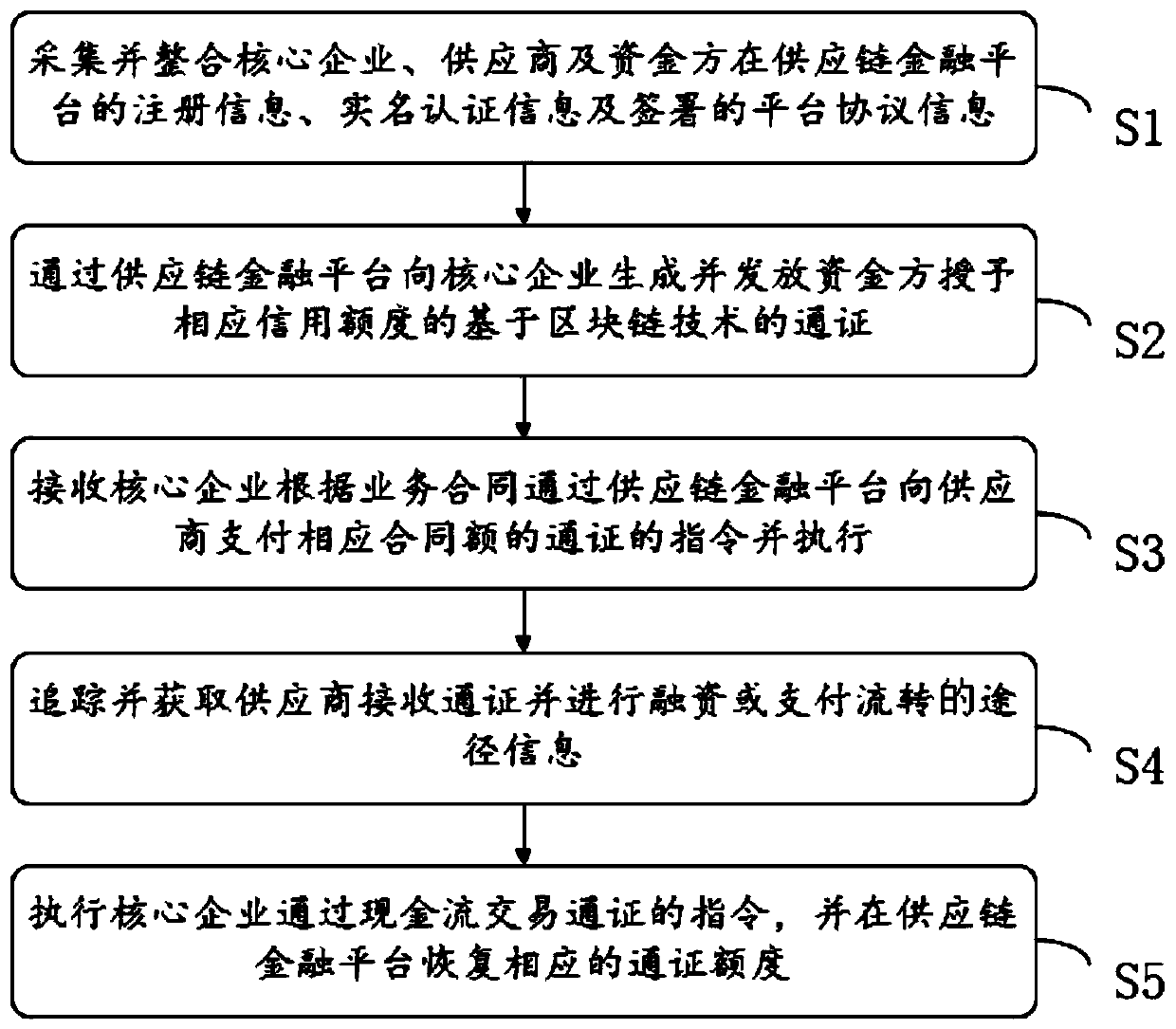

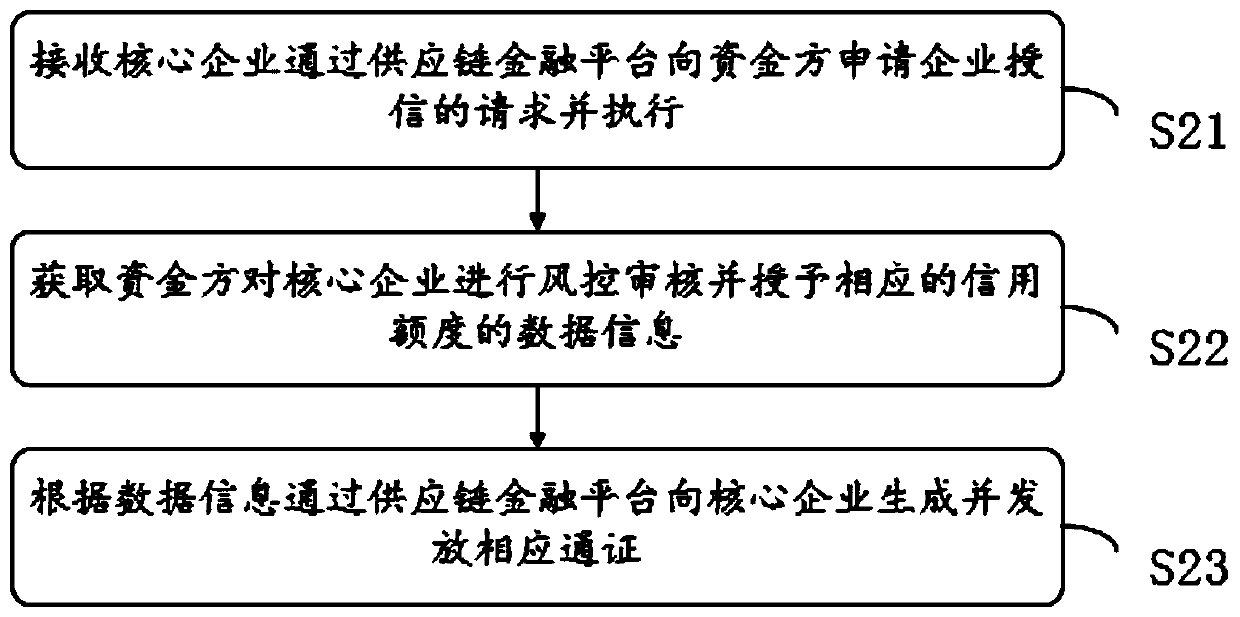

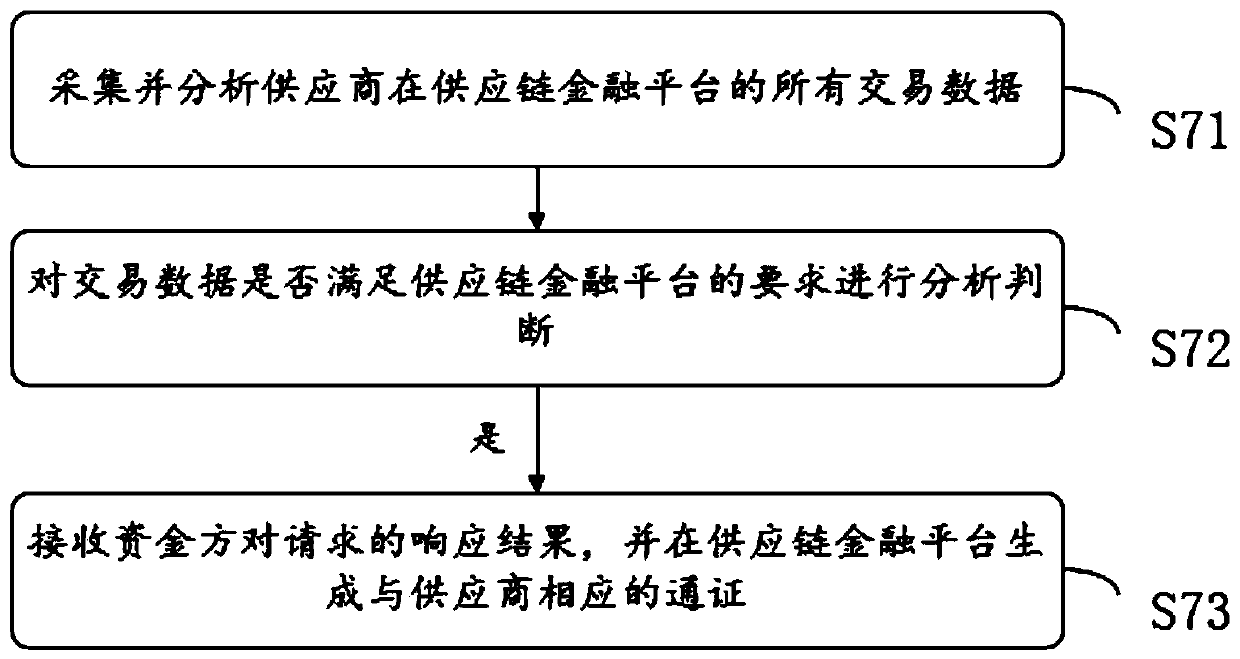

Supply chain financial application method and device based on block chain technology

PendingCN110533538AResolve asymmetrySolve the problems of open and transparent transactionsFinancePaymentCredit limit

The invention belongs to the technical field of block chain finance, and provides a supply chain finance application method and a supply chain finance application device based on the block chain technology. The method comprises the following steps: collecting and integrating the registration information, real-name authentication information and signed platform protocol information of a core enterprise, a supplier and a fund party on a supply chain finance platform; generating and issuing a token based on a block chain technology to the core enterprise through the platform, wherein the token isgranted to the corresponding credit limit by the fund party; receiving and executing an instruction that the core enterprise pays the token of the corresponding quota to the supplier through the platform according to the service contract; tracking and obtaining path information of receiving the token and carrying out financing or payment circulation by the supplier; and executing an instruction that the core enterprise transactions the token through the cash flow, and recovering the limit of the corresponding token on the supply chain financial platform. According to the invention, based on the credit of the core enterprise, the supplier uses the token to finance in the fund party or circulate among suppliers at all levels, thereby solving the technical problem of difficult financing of small and medium-sized enterprises.

Owner:深圳象右看齐网络技术有限公司

Community biometric authentication on a smartphone

ActiveUS9391988B2User identity/authority verificationDigital data authenticationUser deviceBiometric data

Methods and systems are presented for performing biometric authentication of a plurality of users on a user device (e.g., smartphone). In some embodiments, a user may specify in biometric settings certain biometric authentication applications to be used with a group biometric authentication system. A user may additionally specify in biometric settings other users to add to a biometric authentication group. A user may perform functions or access data in biometric authentication-enabled applications (e.g., a financial application) that require the biometric authentication of one or more other users by transmitting a request to the user device of the one or more other users for the required biometric data (e.g., a fingerprint scan).

Owner:GRANDIOS TECH LLC

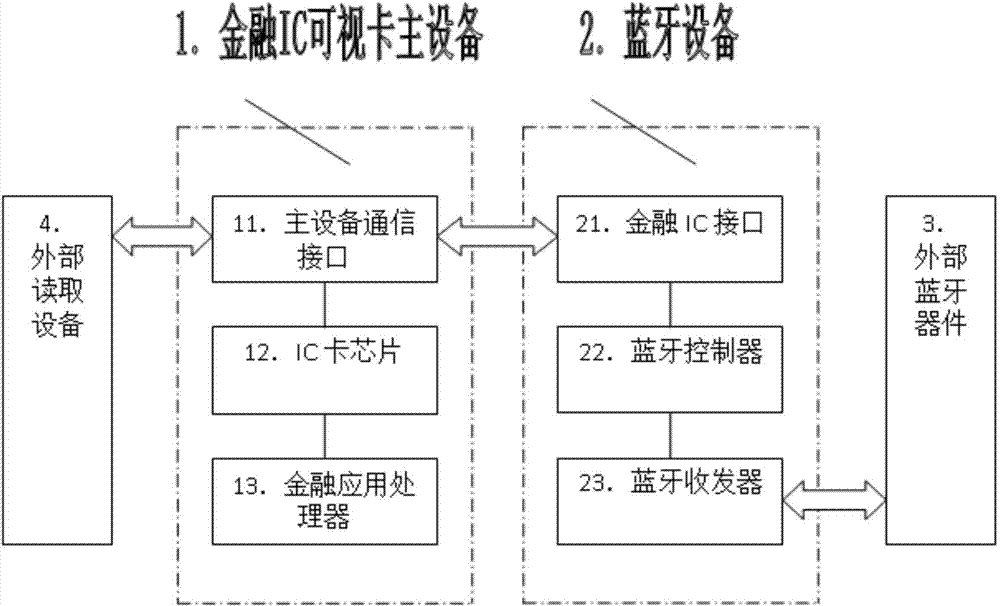

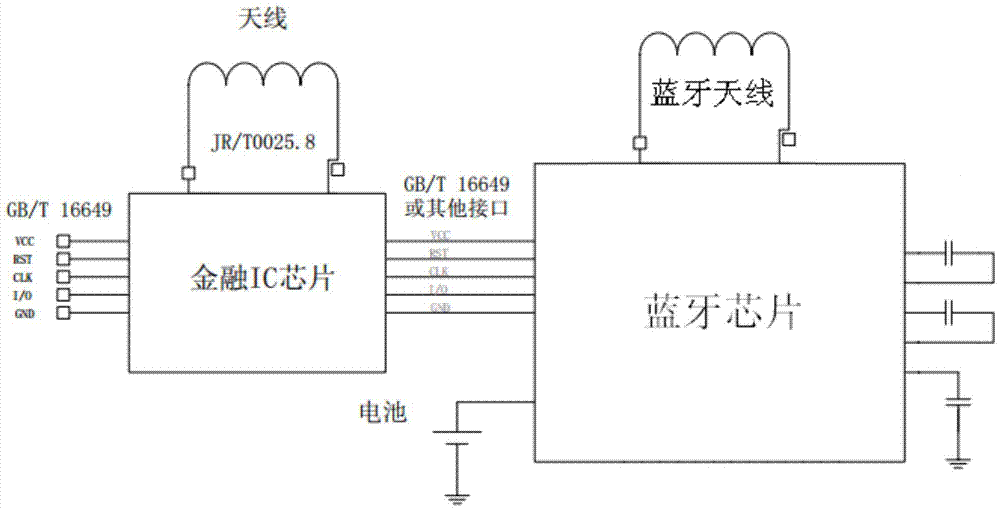

Financial IC visible card provided with Bluetooth device

ActiveCN103577867ASolve the problem of not being able to use the mobile phoneSolve usabilityNear-field transmissionSensing record carriersCommunication interfaceKey pressing

The invention discloses a financial IC visible card provided with a Bluetooth device. The financial IC visible card comprises a financial IC visible card main device and the Bluetooth device. The financial IC visible card main device is composed of a main device communication interface, a financial application processor and an IC card chip operating a COS. The main device communication interface comprises a first communication interface and a second communication interface, wherein the first communication interface is communicated with an external reading device in a both-way mode, and the second communication interface is communicated with the Bluetooth device in a both-way mode. The Bluetooth device is composed of a financial IC interface, a Bluetooth controller and a Bluetooth transceiver. The financial IC interface is connected with the second communication interface, and the Bluetooth transceiver is connected with an external Bluetooth device to be communicated with the external Bluetooth device in a both-way mode. According to the financial IC visible card, the built-in Bluetooth device is wirelessly communicated with the external Bluetooth device, all functions of the IC card are achieved through a large screen of the external Bluetooth device and a plurality of keys, and convenience is brought to a user.

Owner:SHANGHAI PEOPLENET SECURITY TECH

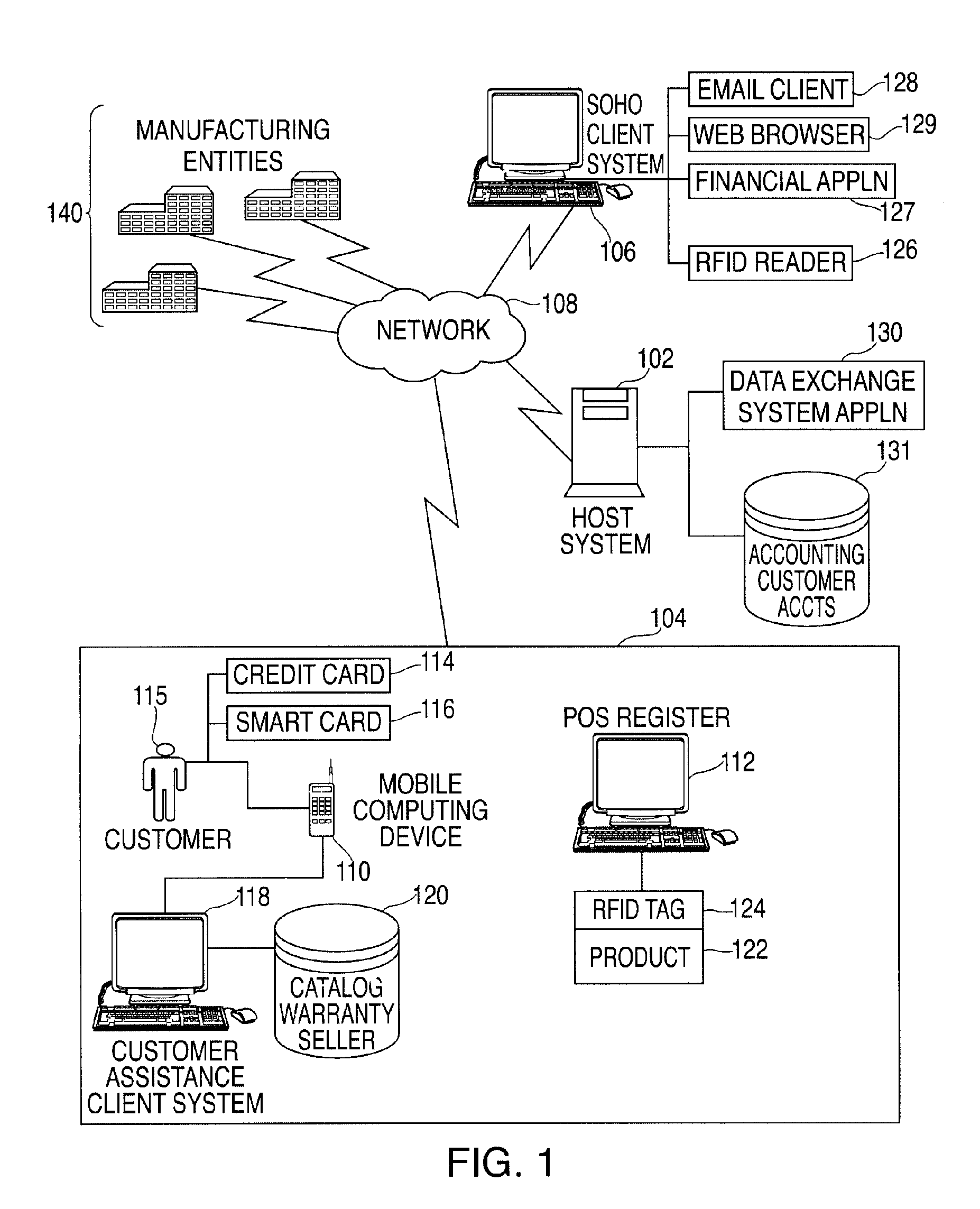

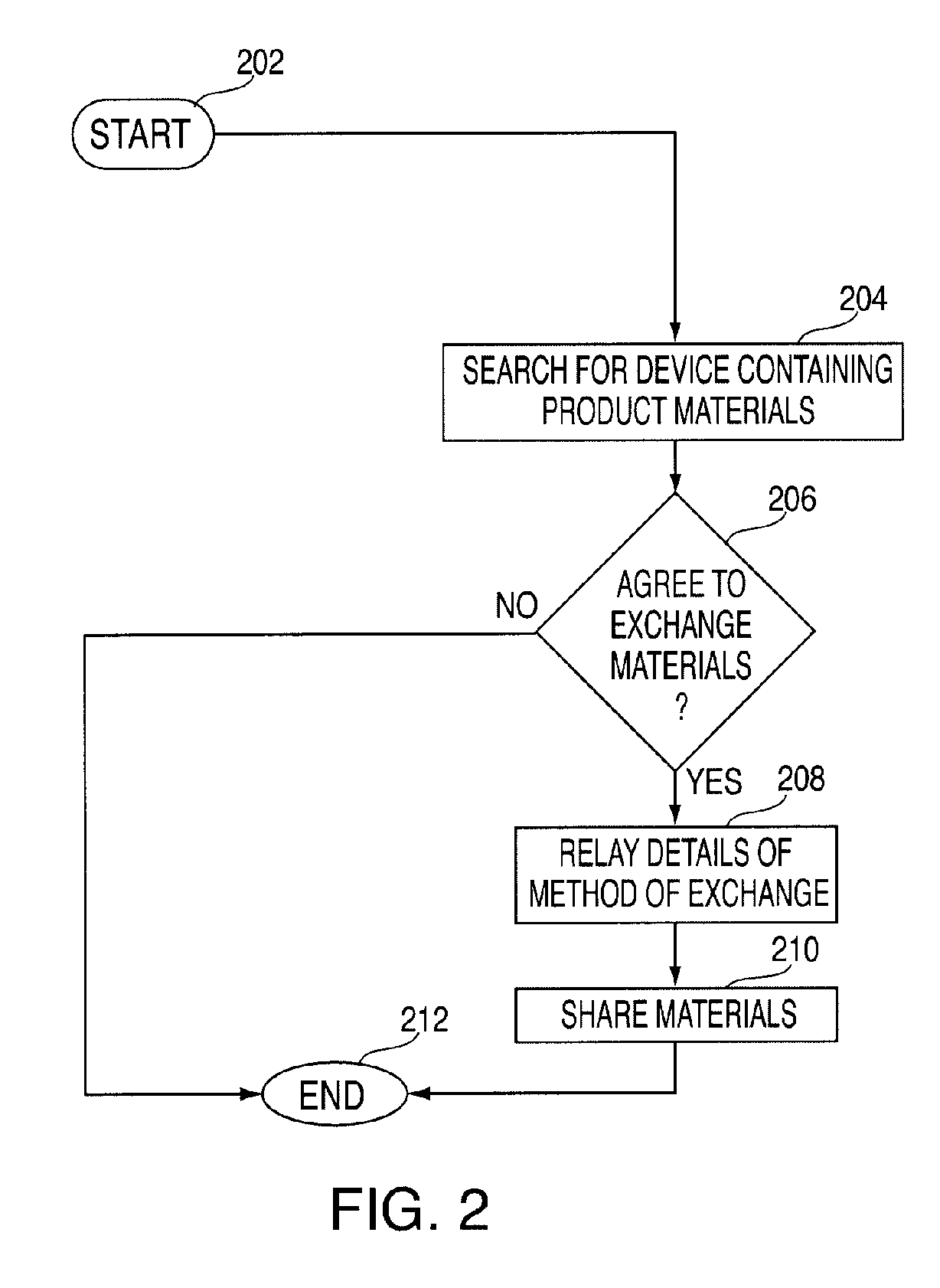

Method, system, and storage medium for implementing transaction-based data exchange

A method for implementing transaction-based data exchange. The method includes transferring information relating to a product via a transmission means selected by an individual at a computing device requesting the information. The information includes at least one of warranty information, accounting information, pricing information, and product details. The method further includes calculating a net worth relating to the product, and updating a financial application associated with the individual with results of the calculating.

Owner:TOSHIBA GLOBAL COMMERCE SOLUTIONS HLDG

System and method for customizing real-time applications on a user interface

A computer-implemented method for customizing a user interface comprises receiving, from a touchpoint device, identification information entered by a user; accessing a record of the user from a database using the received identification information; determining whether the record has any application windows configured for the user interface on the touchpoint device; transmitting, by a server to the touchpoint device, at least a first financial application window and a second financial application window identified by the record of the user for display of the first financial application window and the second financial application window simultaneously on the user interface of the touchpoint device; receiving instructions from the user via the first financial application window to perform a financial transaction; and performing, by a server, the financial transaction while the touchpoint device displays at least the first financial application window and the second financial application window, wherein the first financial application window and the second financial application window are updated with real-time information.

Owner:CITIBANK

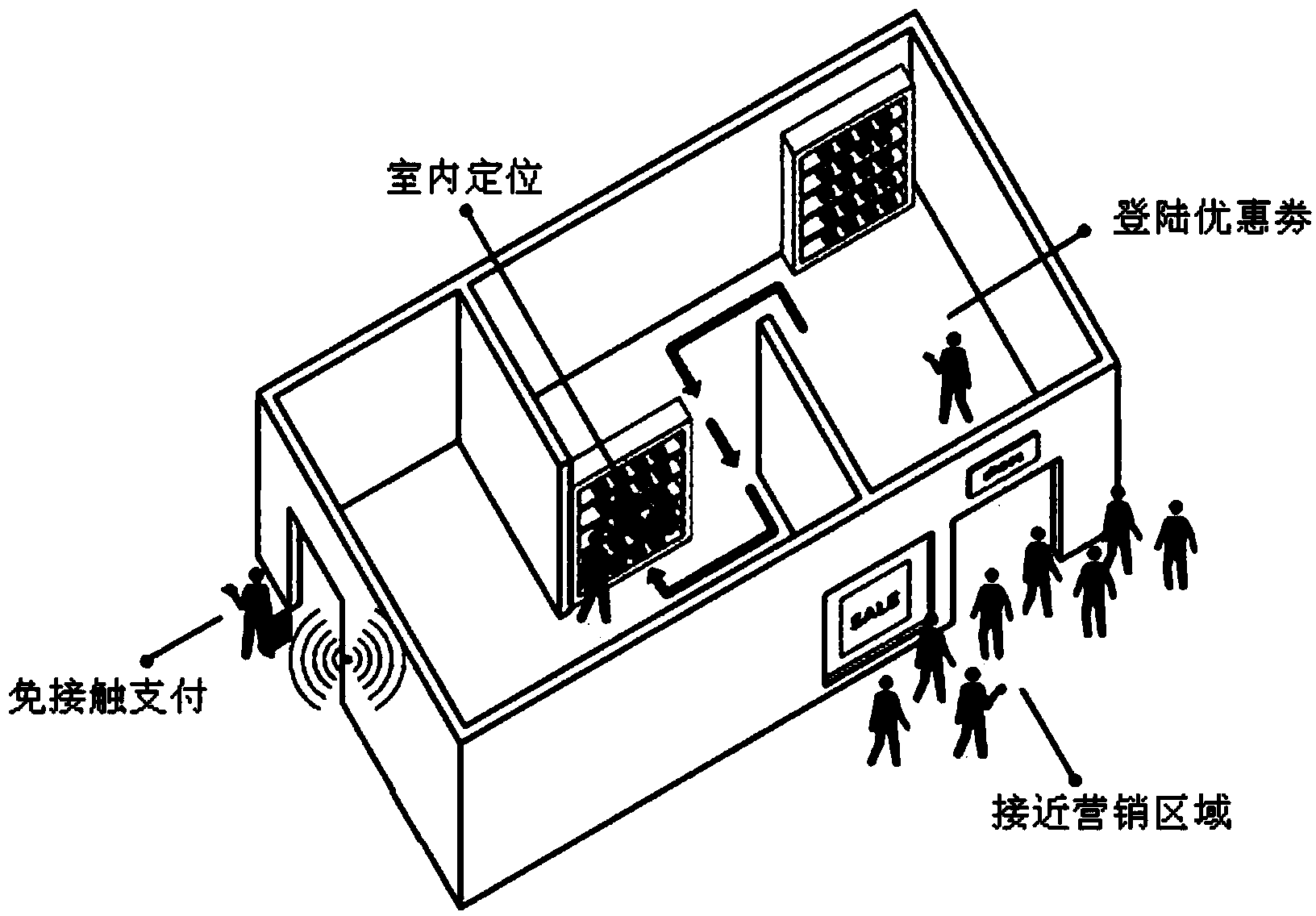

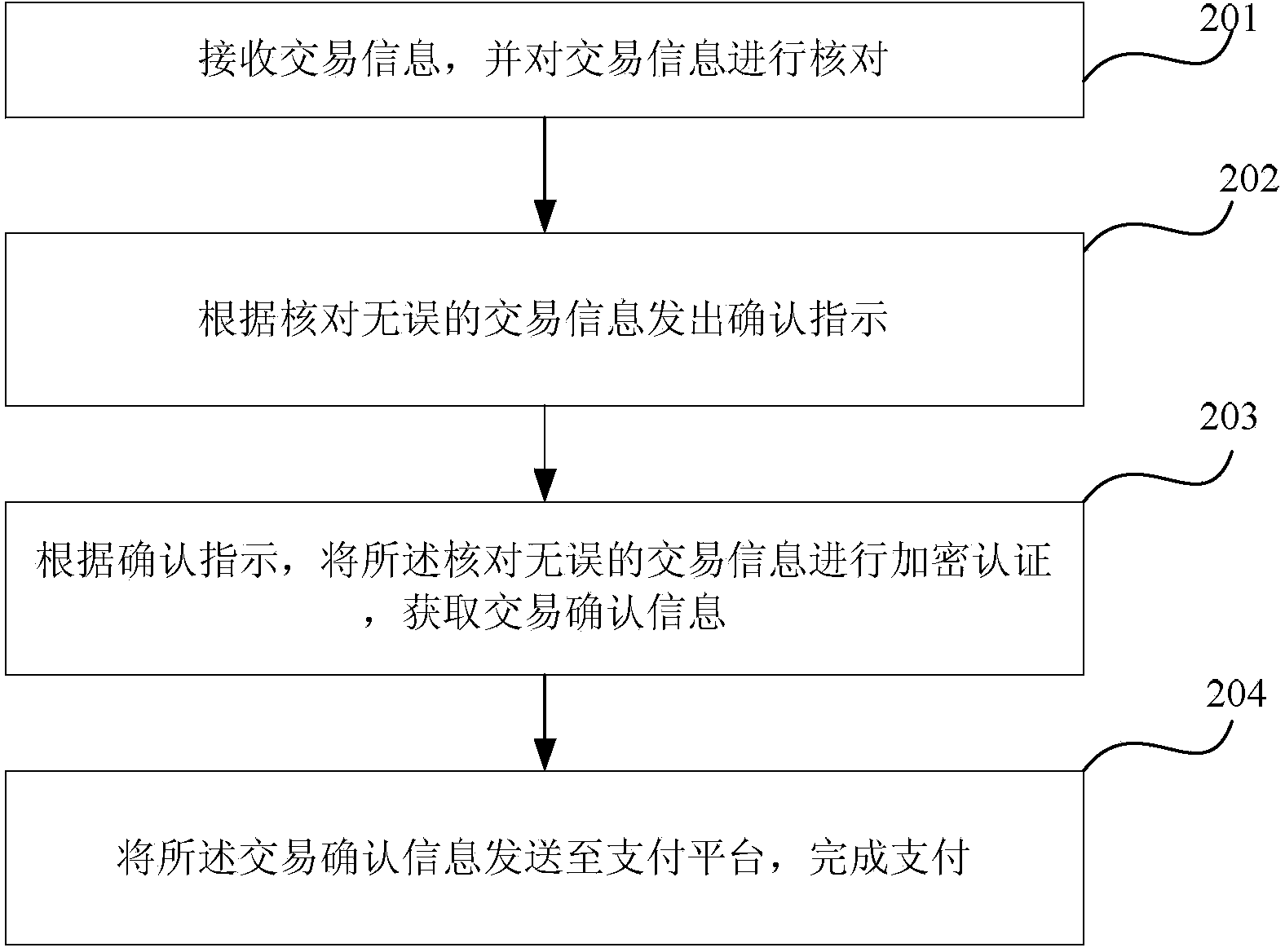

Non-card payment method and device

InactiveCN103955820AAvoid the problem of poor payment securityPayment architectureFinancial transactionFinancial application

The invention provides a non-card payment method and device. The method is carried out on an external device only provided with a financial application, trade information is received, and the trade information is checked; a confirm instruction is sent for the correct trade information after verification, wherein the confirm instruction is expressed to be execution of a corresponding trade; encrypted authentication is carried out according to the correct trade information after verification, and trade confirm information is obtained; the trade confirm information is sent to a payment platform, and payment is finished. According to the technical scheme, before the payment trade is executed, a client carries out safety confirmation through the special external device, the encrypted authentication is carried out on the trade confirm information, and the safer trade is achieved.

Owner:GIESECKE & DEVRIENT (CHINA) INFORMATION TECH CO LTD

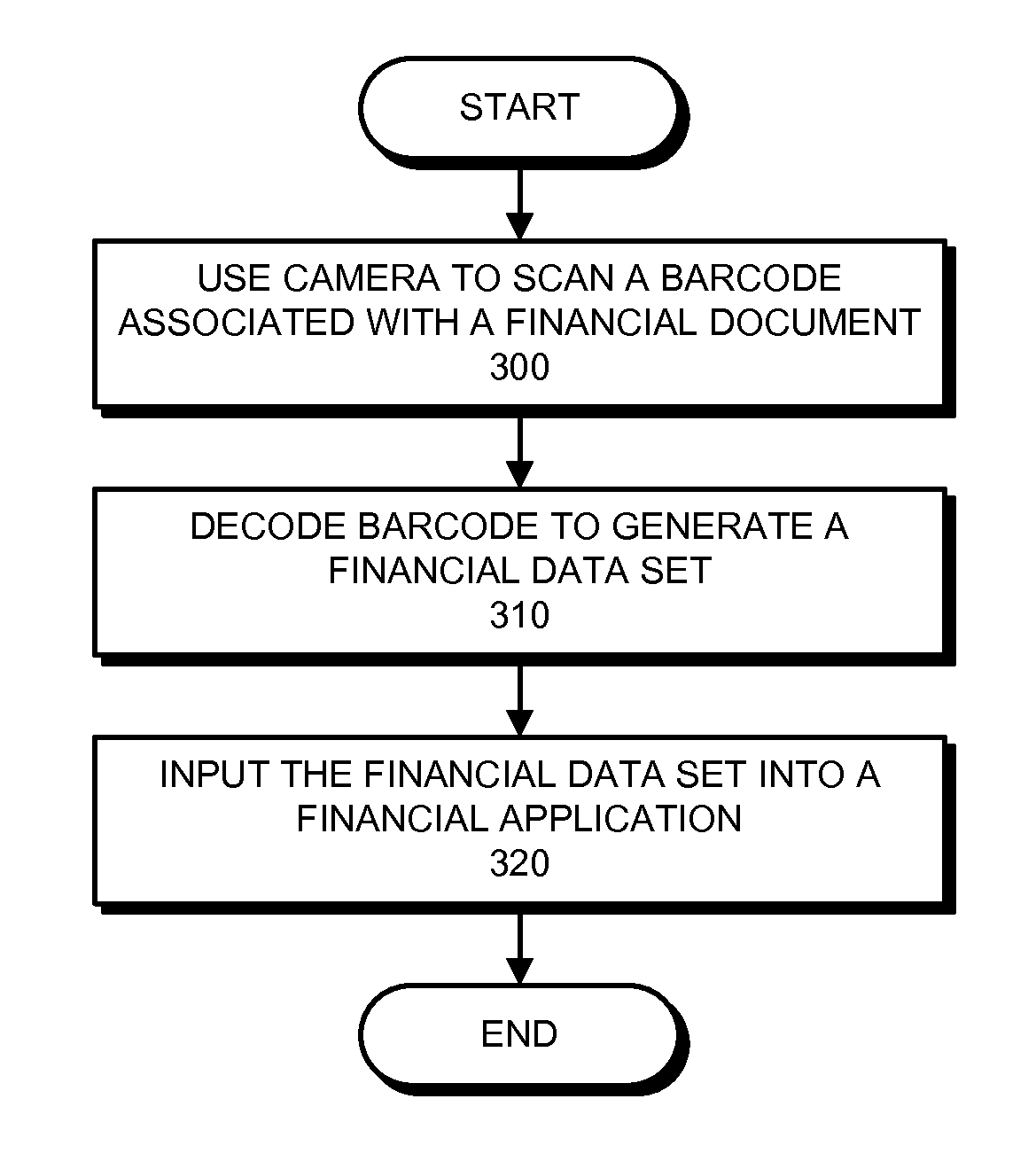

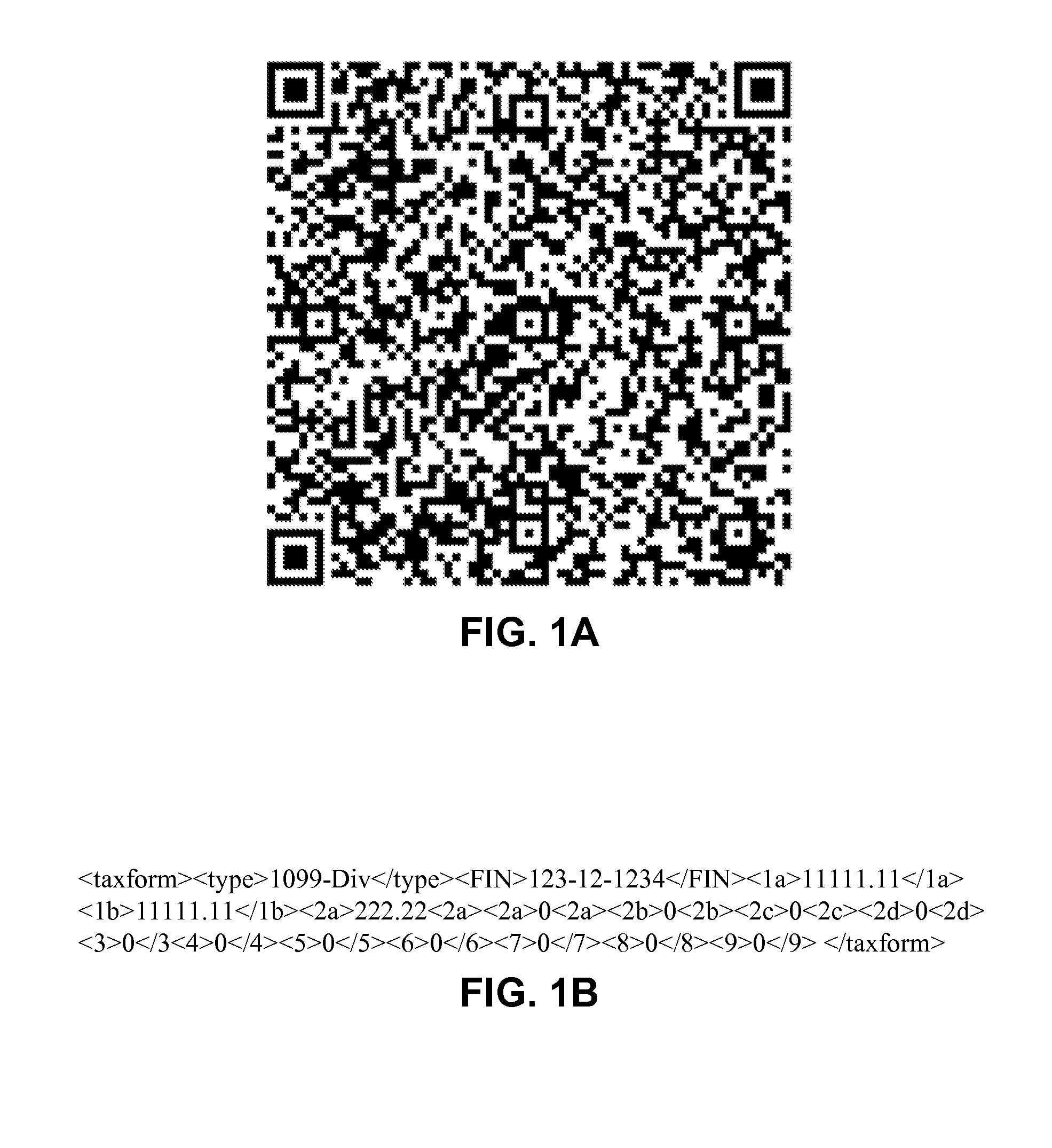

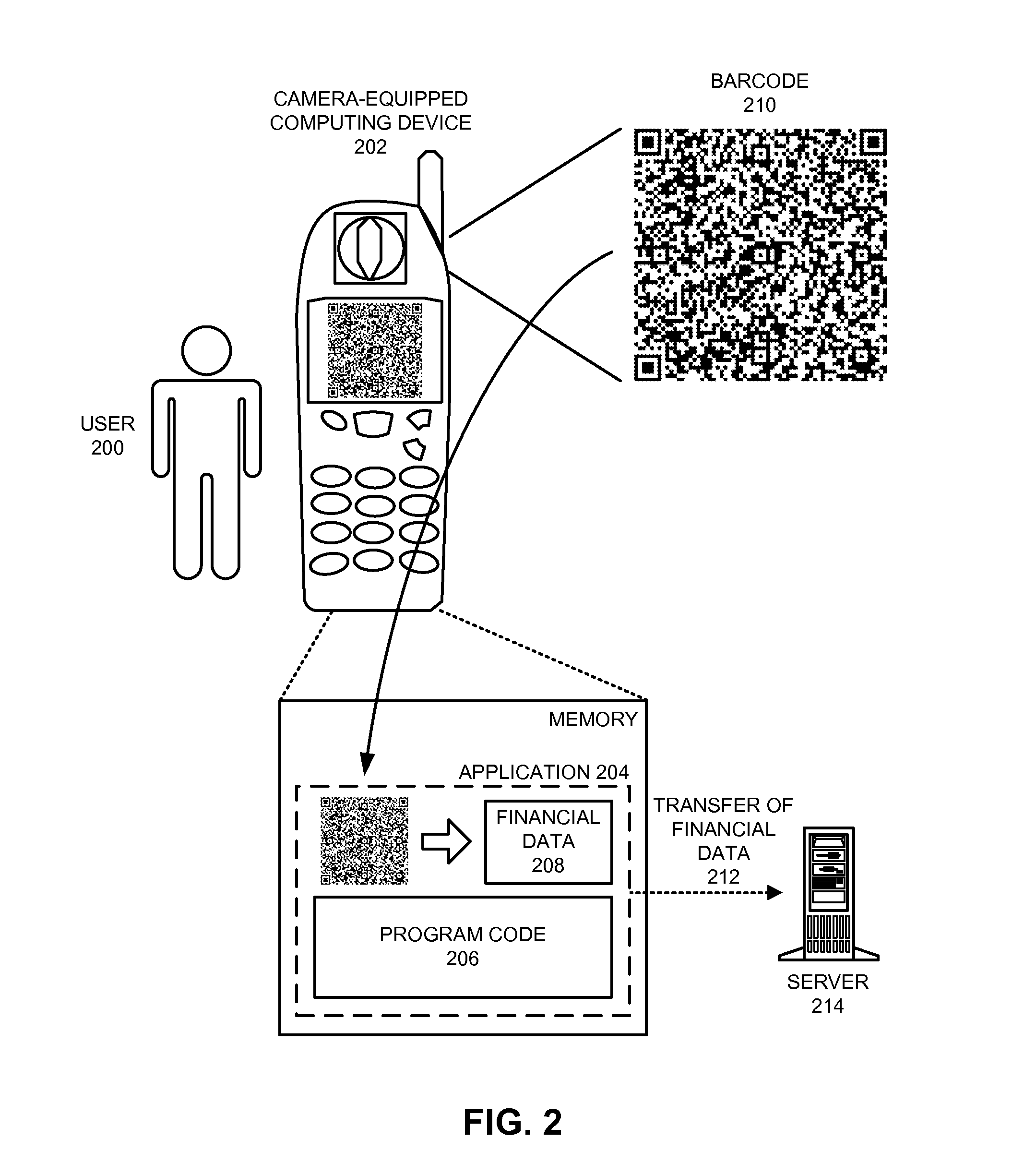

Method and apparatus for capturing financial data using a camera-equipped computing device

InactiveUS20120197805A1Reduce errorsImproves data entry experienceFinancePublic key for secure communicationData setBarcode

The disclosed embodiments provide a system that captures financial data using a camera. During operation, the system uses the camera to scan a barcode that is associated with a financial document. The system decodes the barcode to generate a financial data set that is then input into a financial application. Allowing data to be input by capturing and decoding a scanned barcode reduces errors and generally improves the user data entry experience.

Owner:INTUIT INC

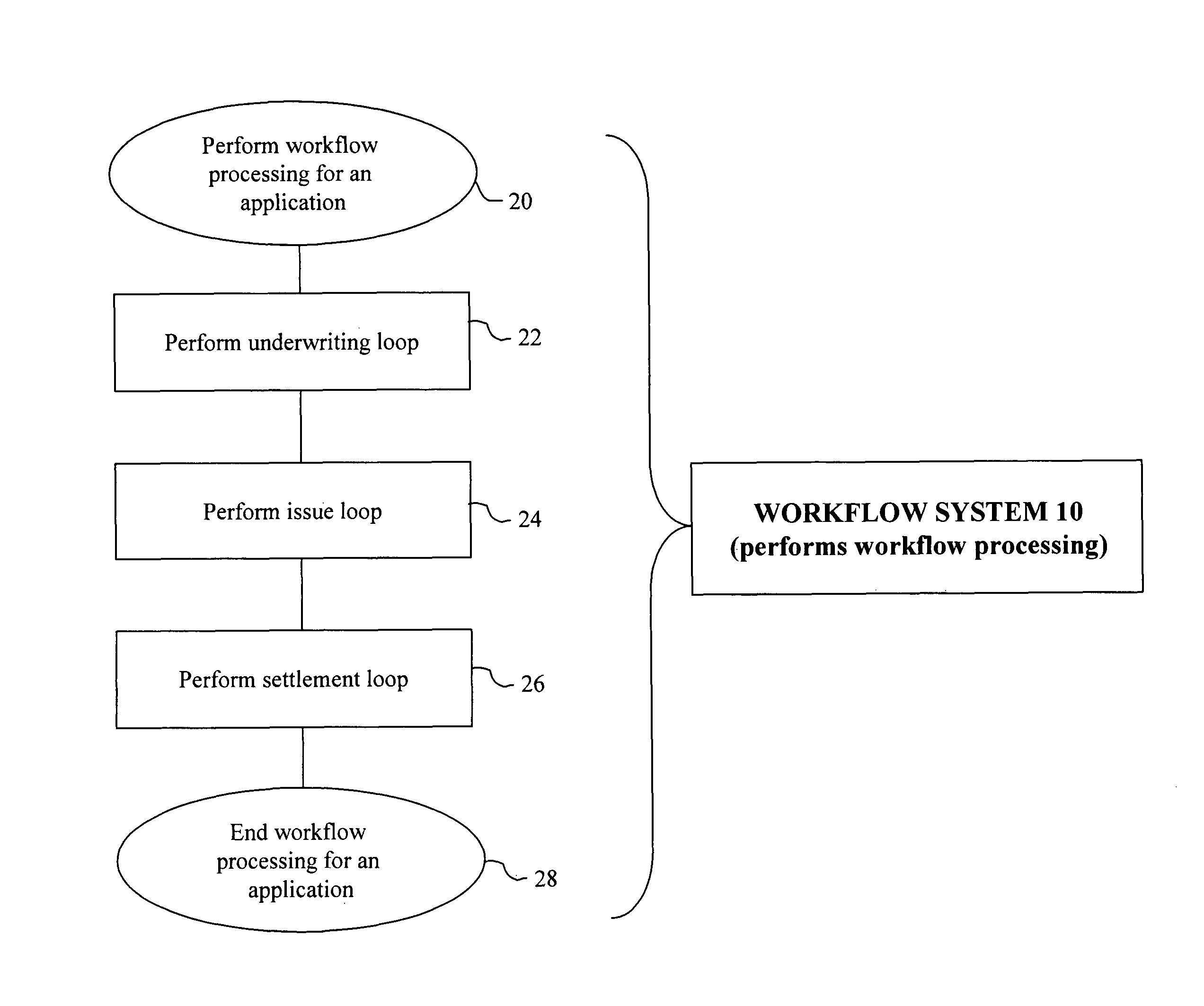

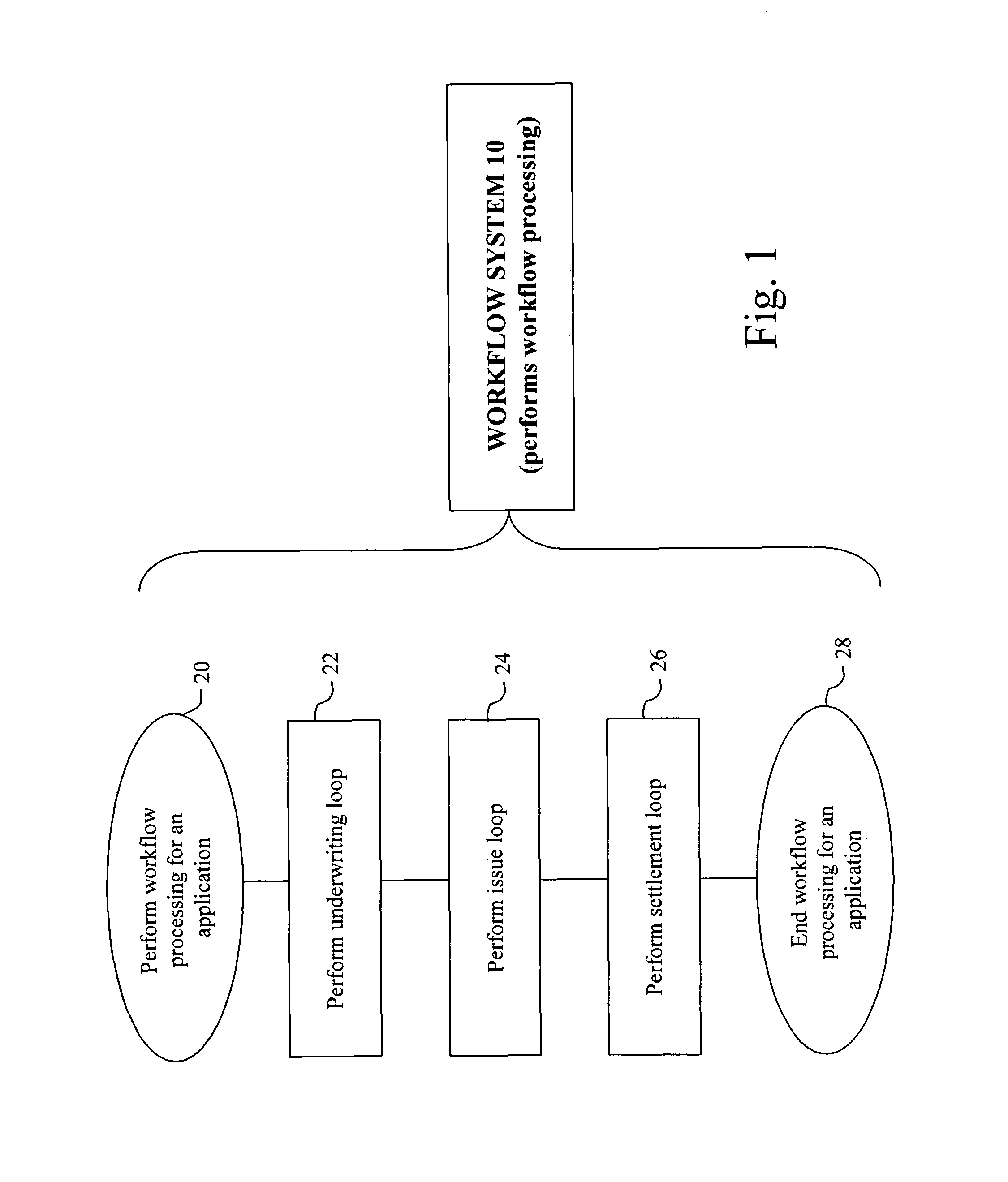

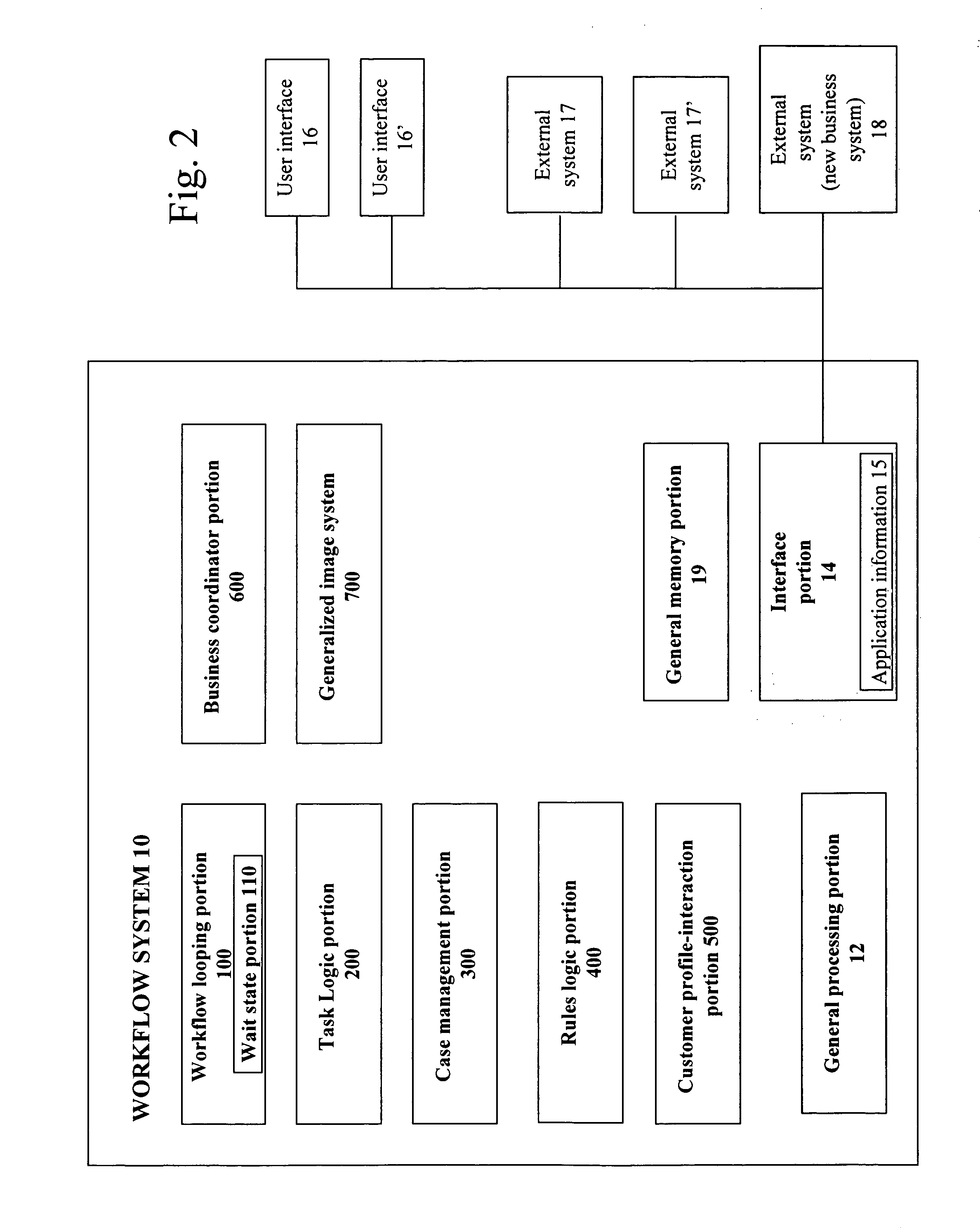

Systems and methods for performing workflow

The systems and methods of the invention provide a workflow system for processing a financial application in an automated manner. The workflow system may include an interface portion, the interface portion inputting application information into the workflow system for processing by the workflow system and a workflow looping portion. The workflow looping portion may include performing underwriting processing to effect underwriting of the application based on the application information, performing issue processing to effect issue of the application, and performing settlement processing to effect settlement of the application. A rules logic portion may be provided to control the implementation of rules applied to the processing of the application as the application passes through the automated processing. The performing underwriting processing, performing issue processing and performing settlement processing are each performed in an automated manner to constitute automated processing of the application, such that the automated processing includes the performing underwriting processing, performing issue processing and performing settlement processing.

Owner:GENWORTH HLDG

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com