Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

631 results about "Customer identification" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A Customer Identification Program (CIP) is a United States requirement, where financial institutions need to verify the identity of individuals wishing to conduct financial transactions with them and is a provision of the USA Patriot Act.

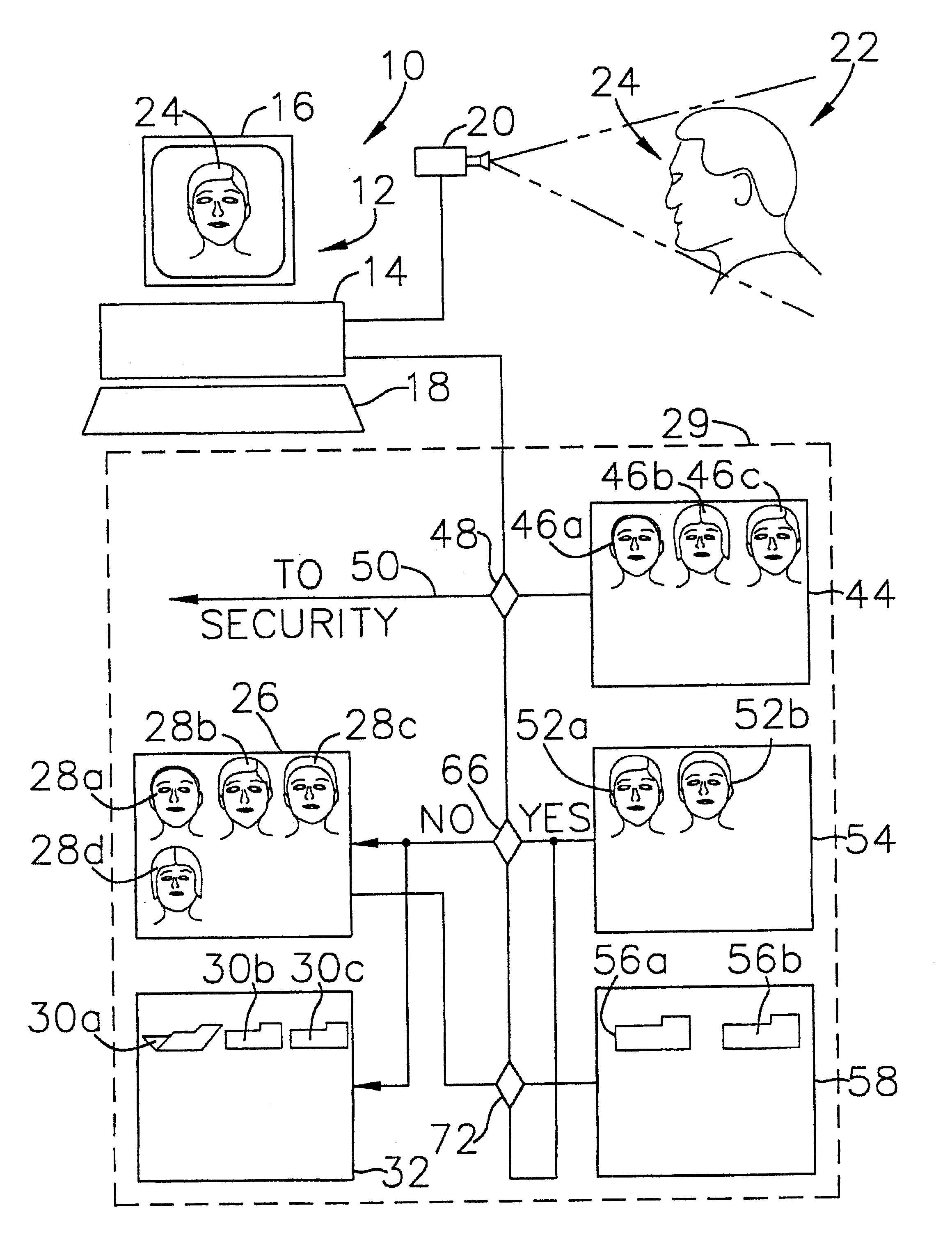

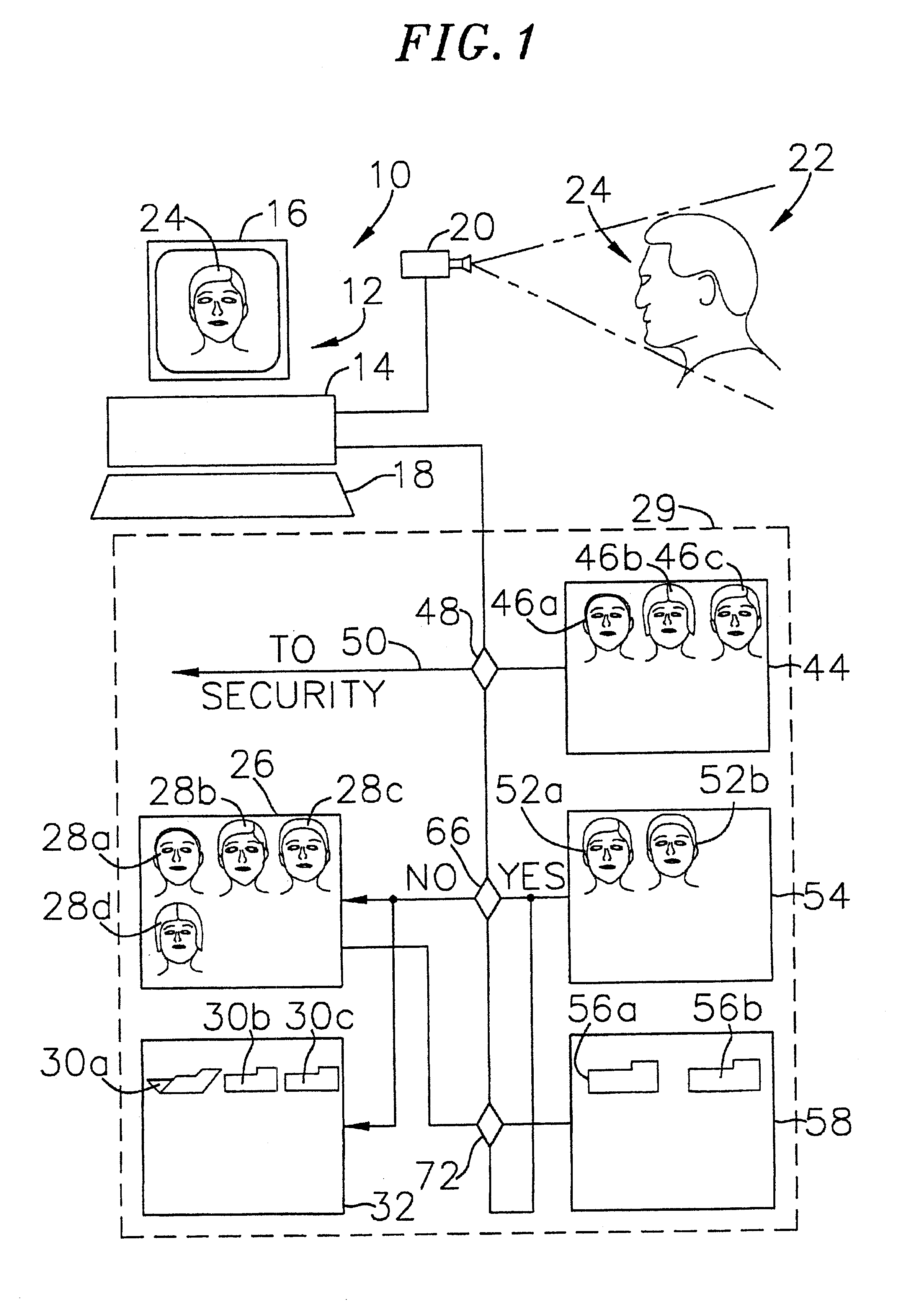

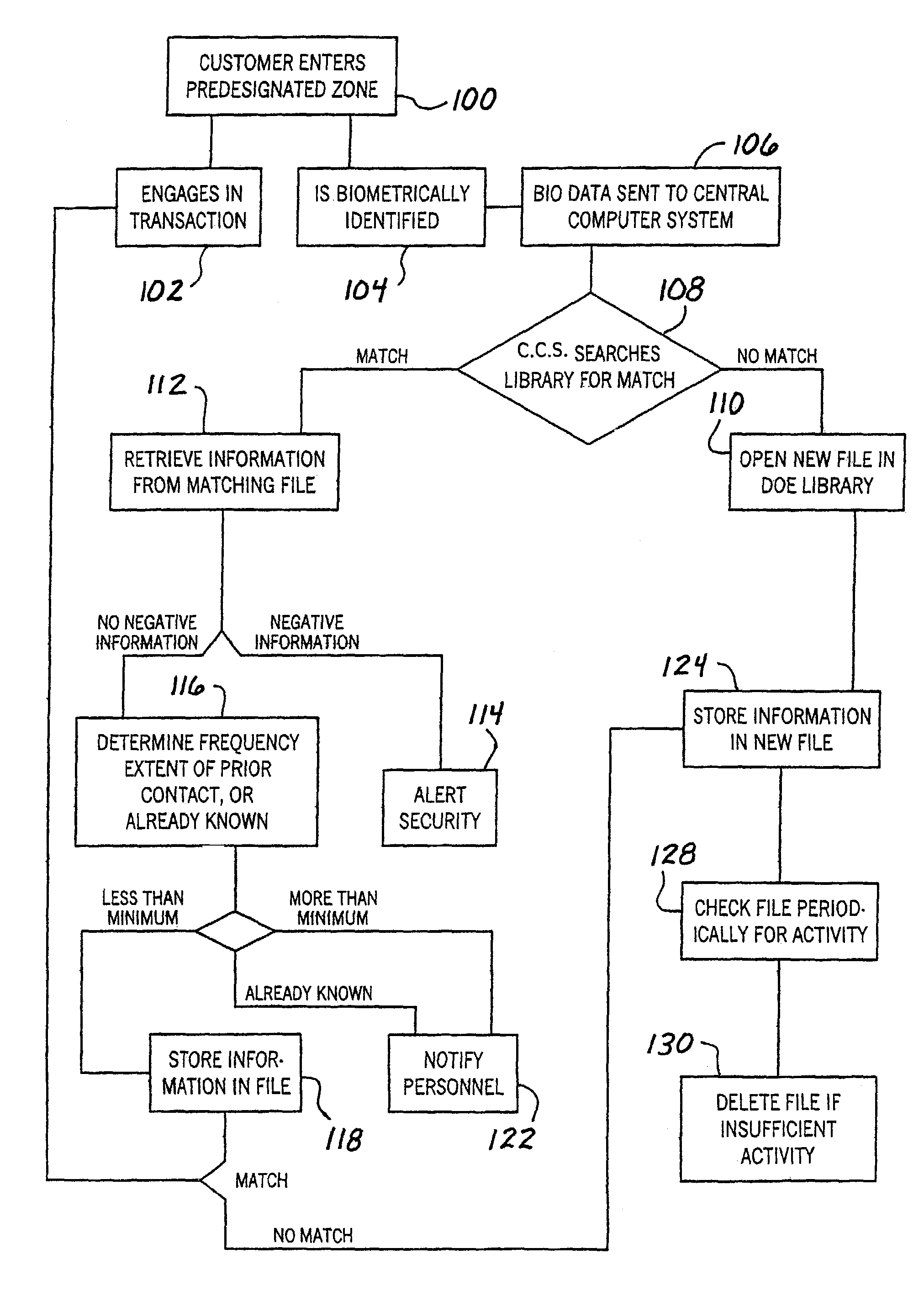

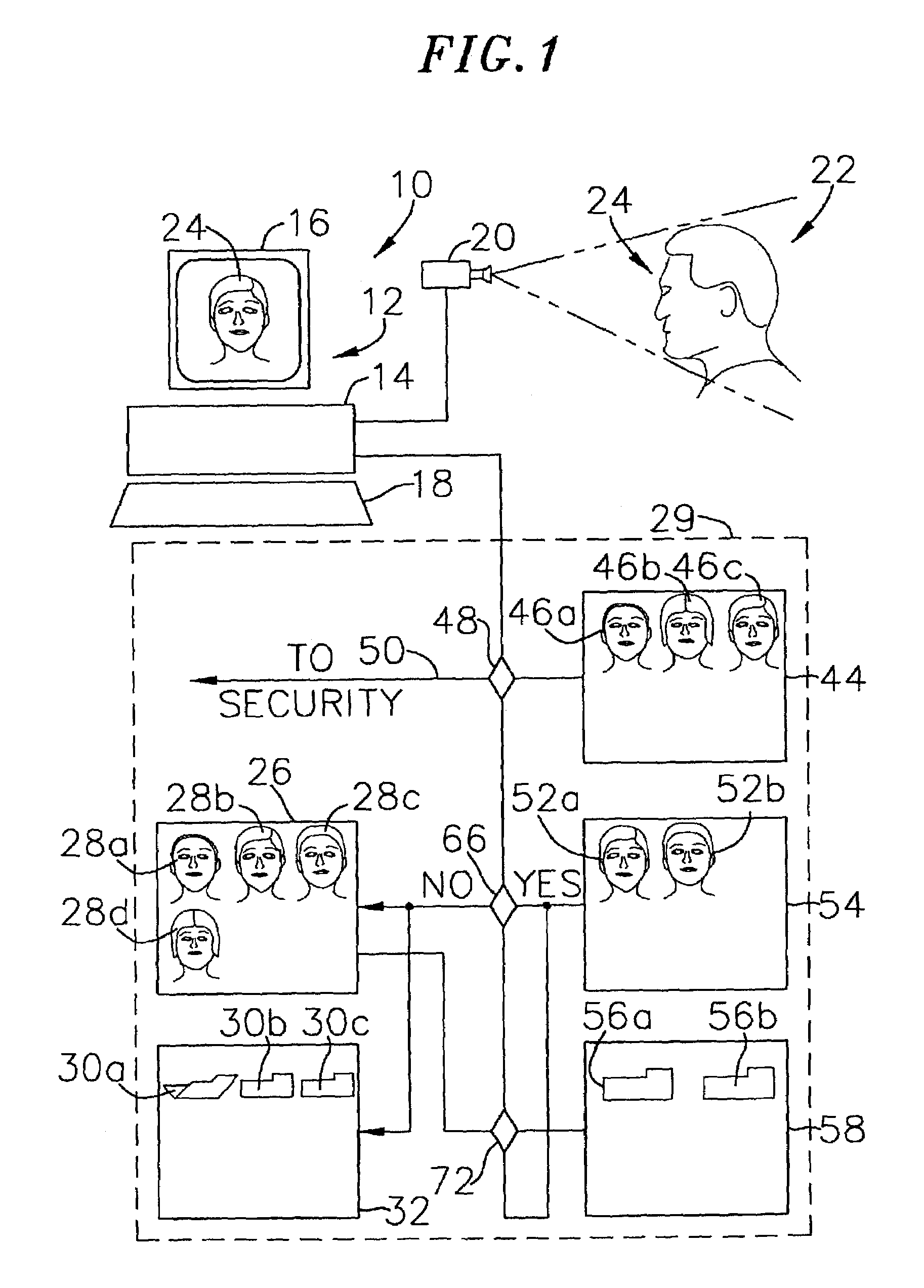

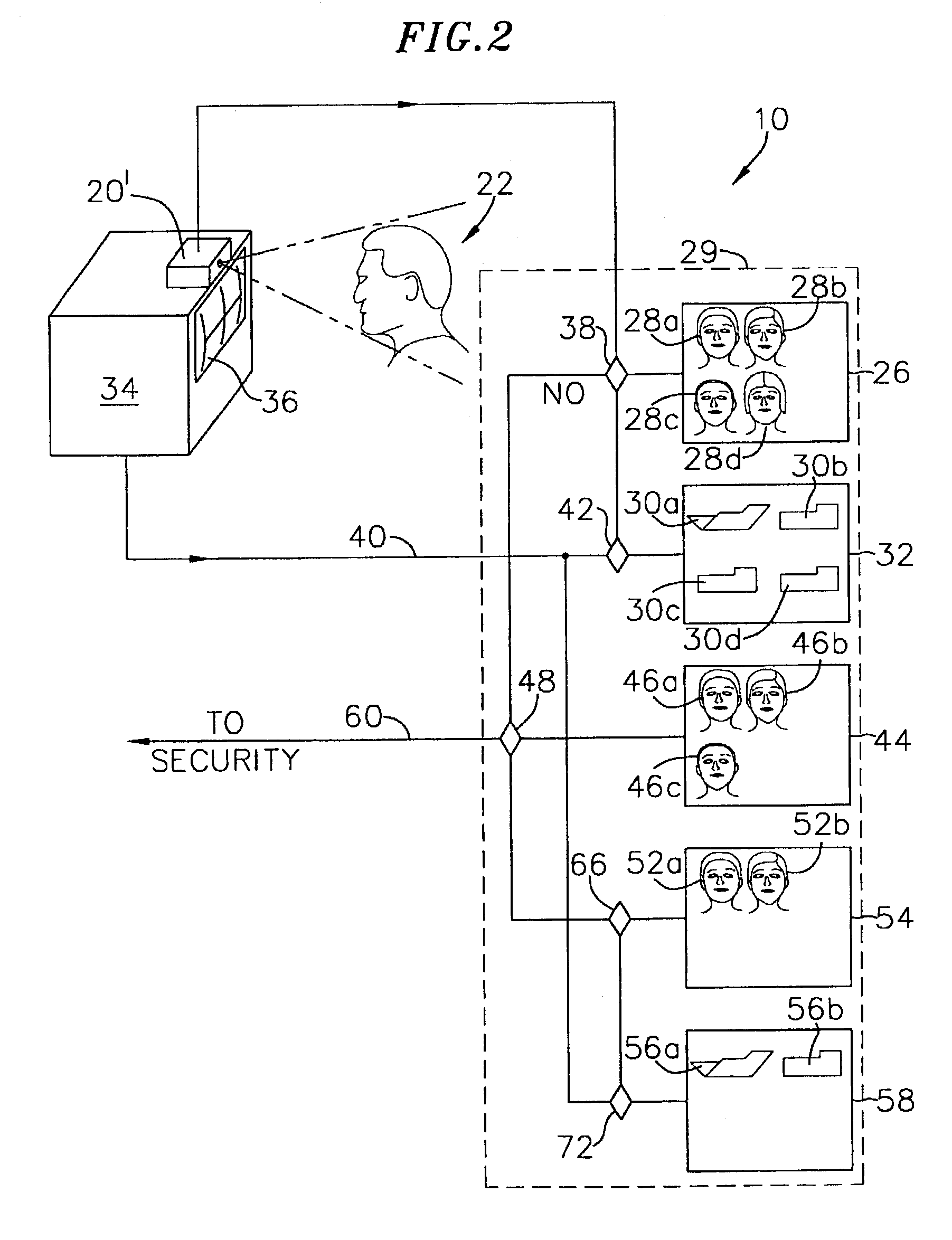

Passive biometric customer identification and tracking system

InactiveUS6554705B1Simplifies search techniqueMinimal useCharacter and pattern recognitionApparatus for meter-controlled dispensingBiometric dataFile allocation

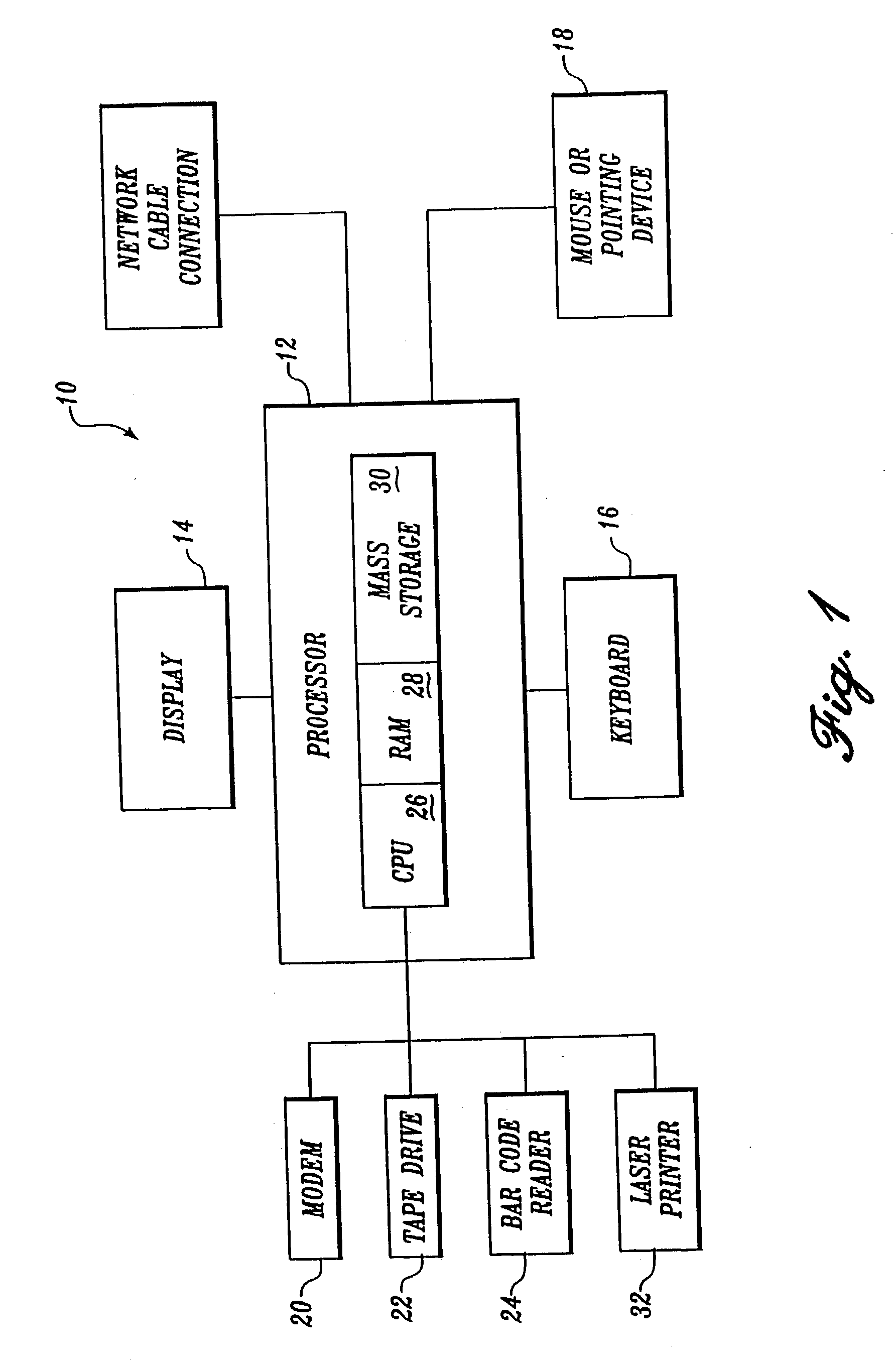

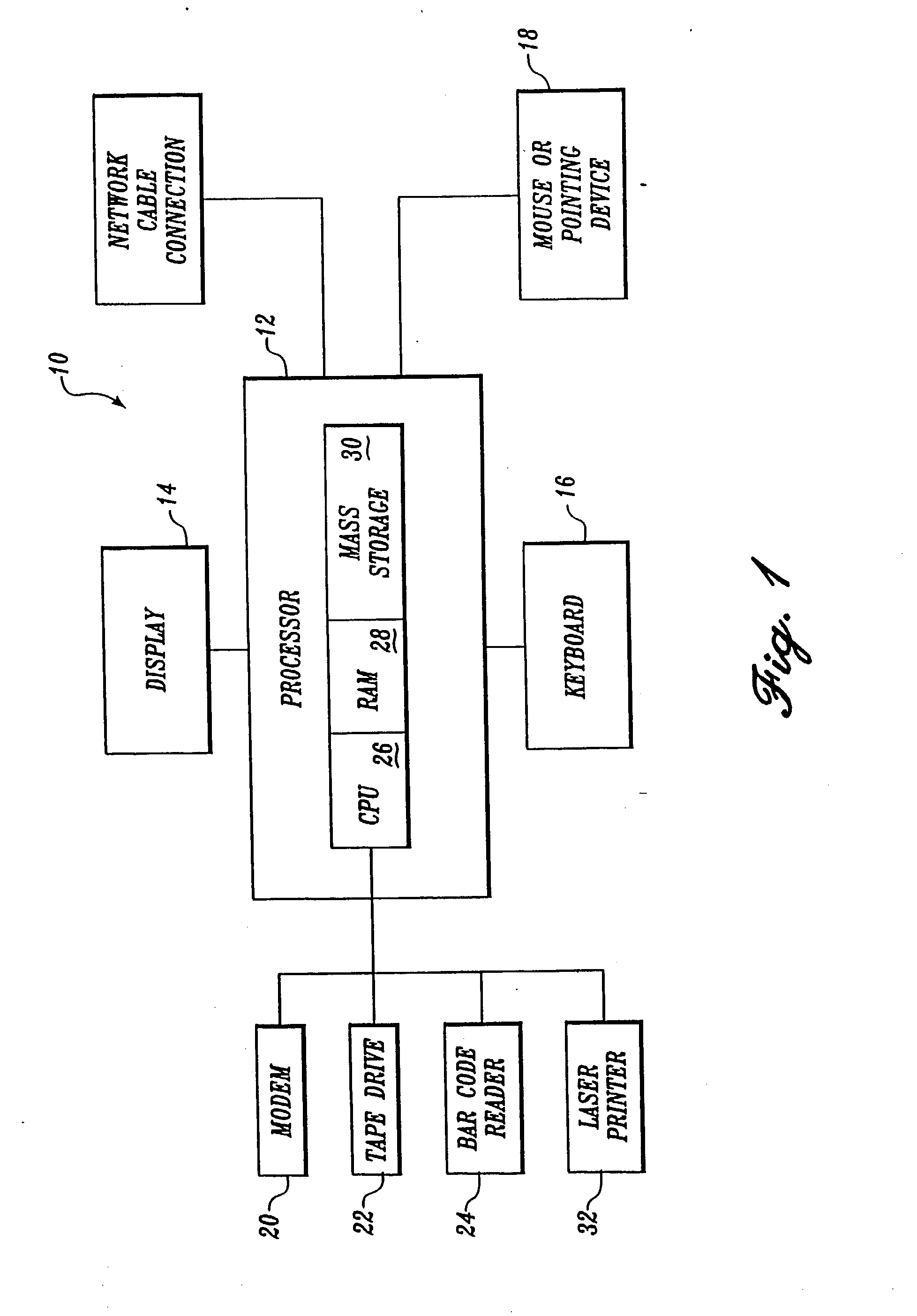

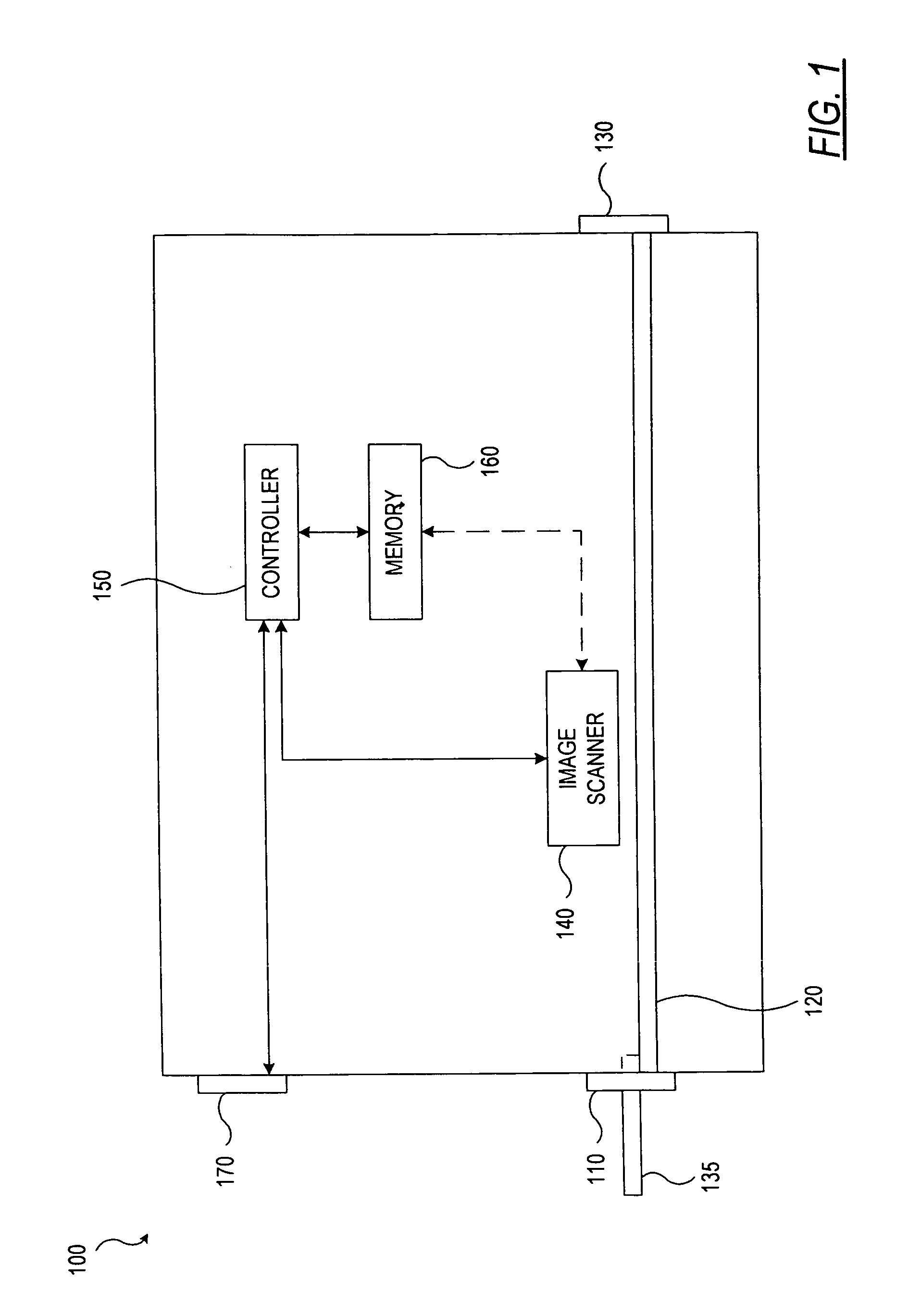

A computer-based customer tracking system uses a passive biometric identification for identifying customers. Neither the customer, nor any establishment personnel, are required to enter any informational data with respect to the customer; identification is done completely biometrically. Biometric identification information is sent to a central computer processor, which searches files in a library for matching biometric data. If no match is found, the processor opens a new file in the library, assigning a code or identification number to the file. Information with respect to the customer's biometric data, along with any transactional information, are stored in the file. If prior activity information stored in the file exceeds a predetermined level, information with respect to the customer's prior activity is retrieved from the file and sent to a terminal, preferably at the location of the transaction. Any new information from the transaction is then sent to the processor and stored for future access. The processor scans the files periodically, and deletes files for which the activity level in the file is below a certain predetermined level over a preselected time period. Deletion of inactive files precludes the processor memory from being overloaded with information which is not useful to the establishment, and also reduces the amount of time necessary for the processor to search library files for biometric matches.

Owner:BIOMETRIC RECOGNITION

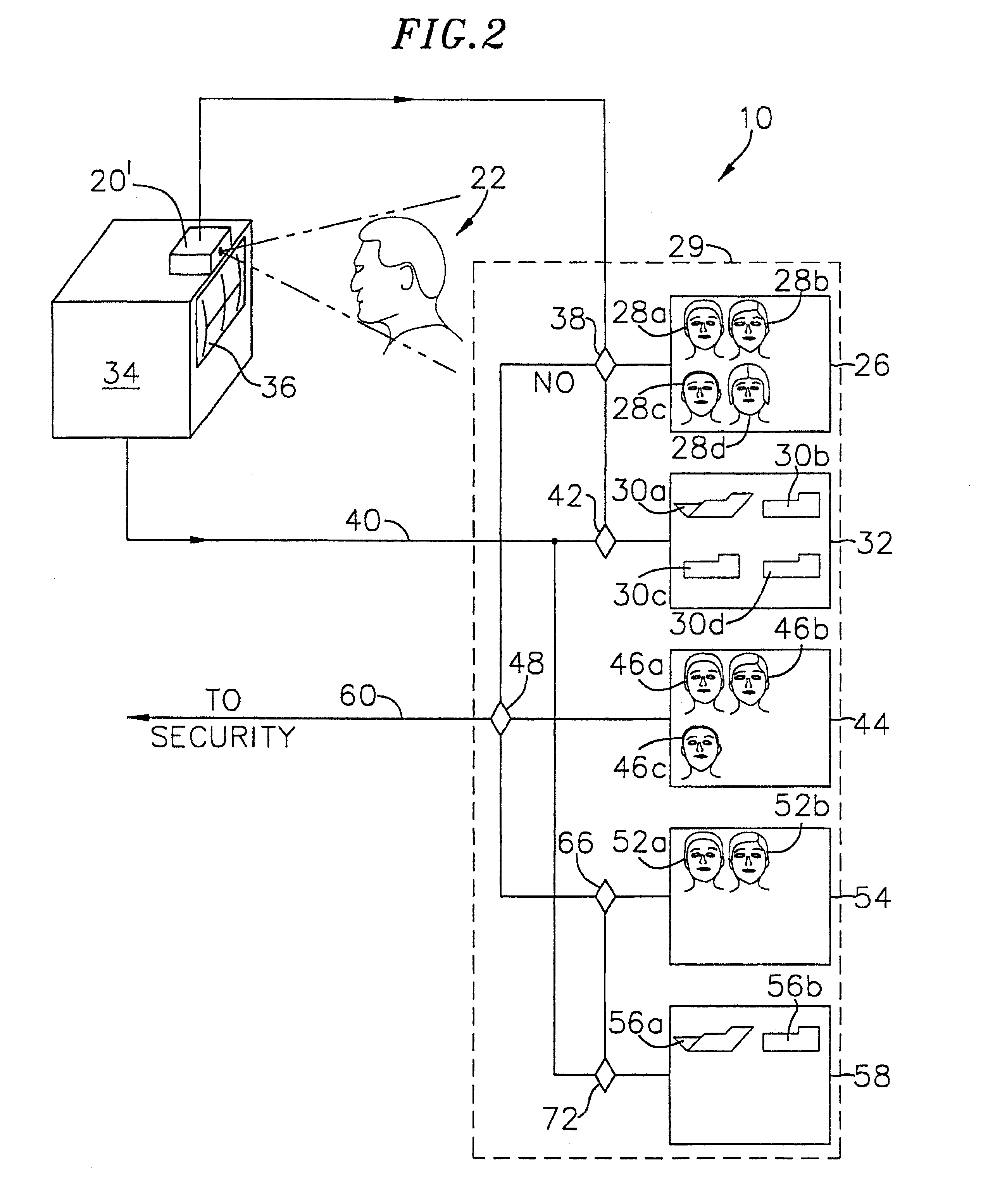

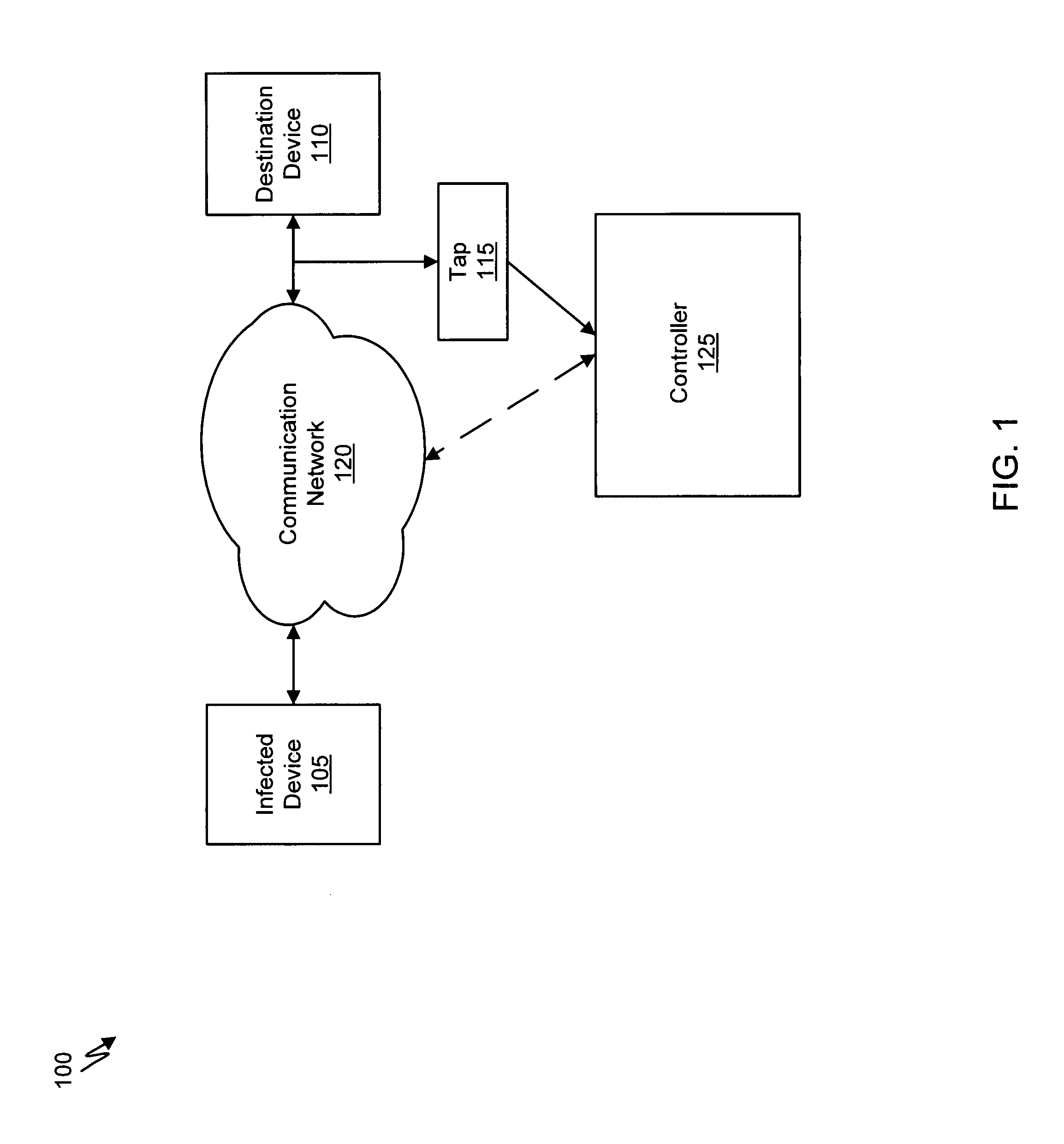

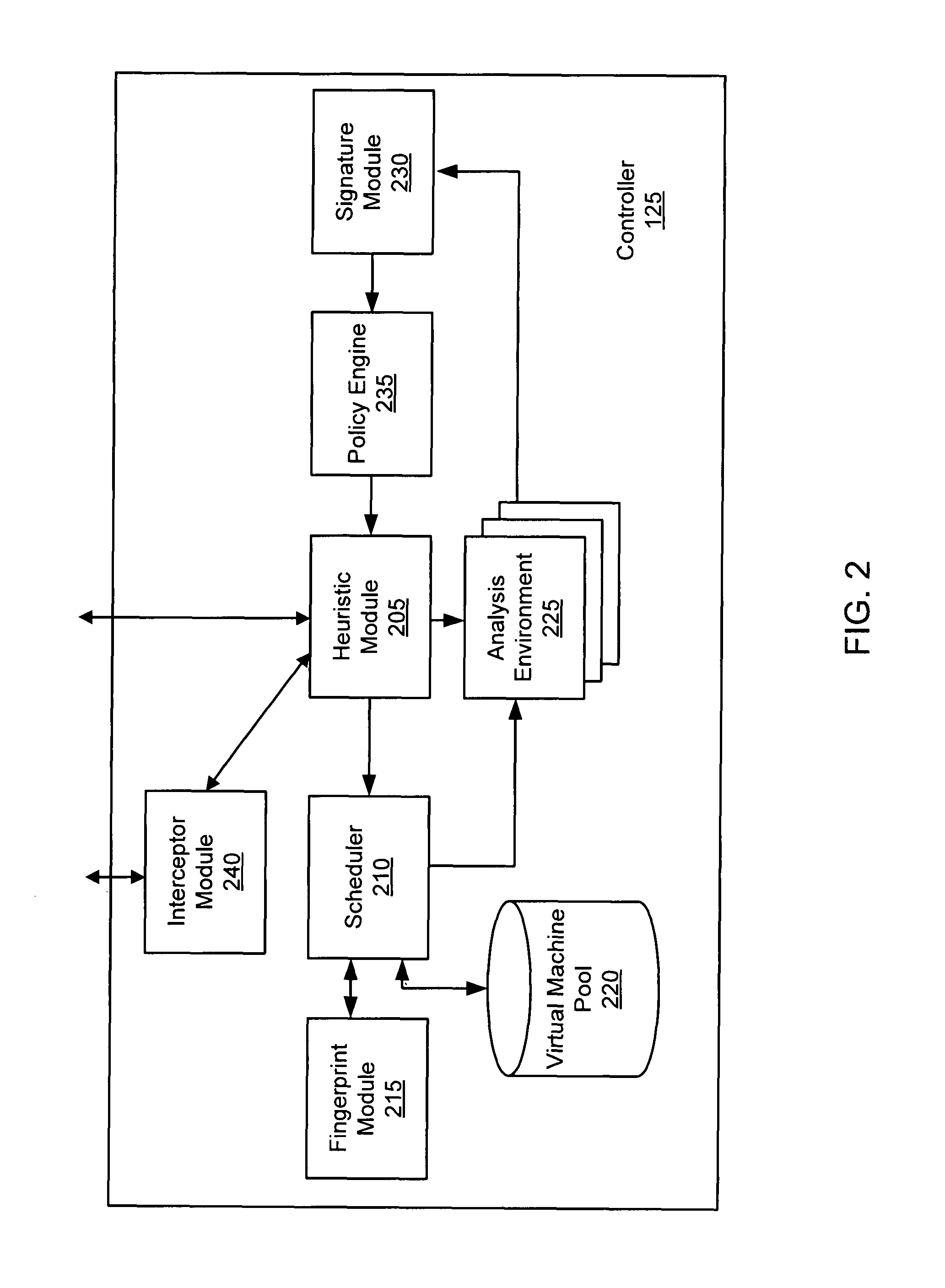

Prospective client identification using malware attack detection

Systems and methods for prospective client identification using malware attack detection are provided. A malware device is identified. The entity with the responsibility for the malware device or a potentially compromised device in communication with the malware device is determined. A message is communicated to the entity based on the determination. In various embodiments, the message comprises an offer for security related products and / or services.

Owner:FIREEYE SECURITY HLDG US LLC

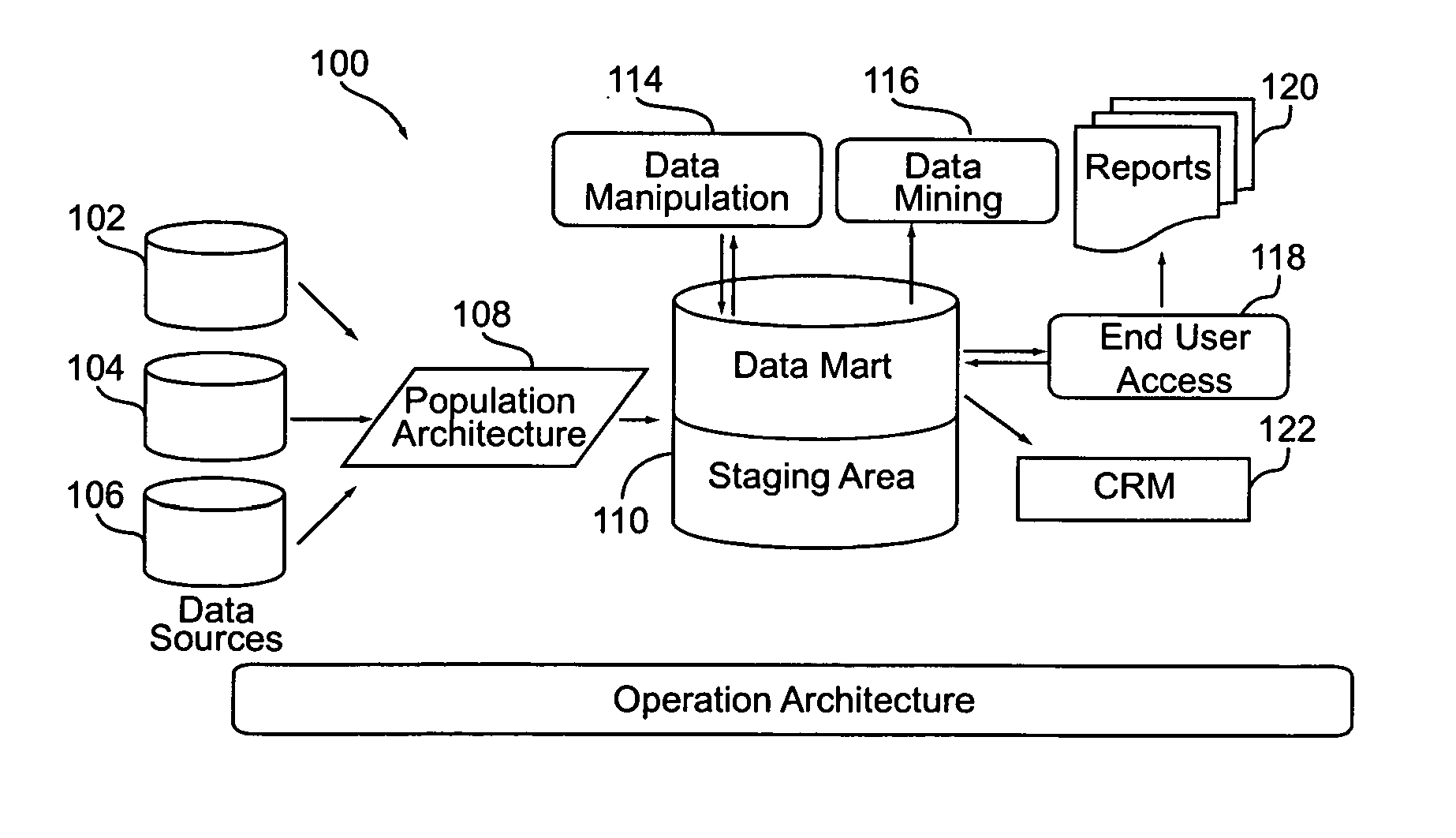

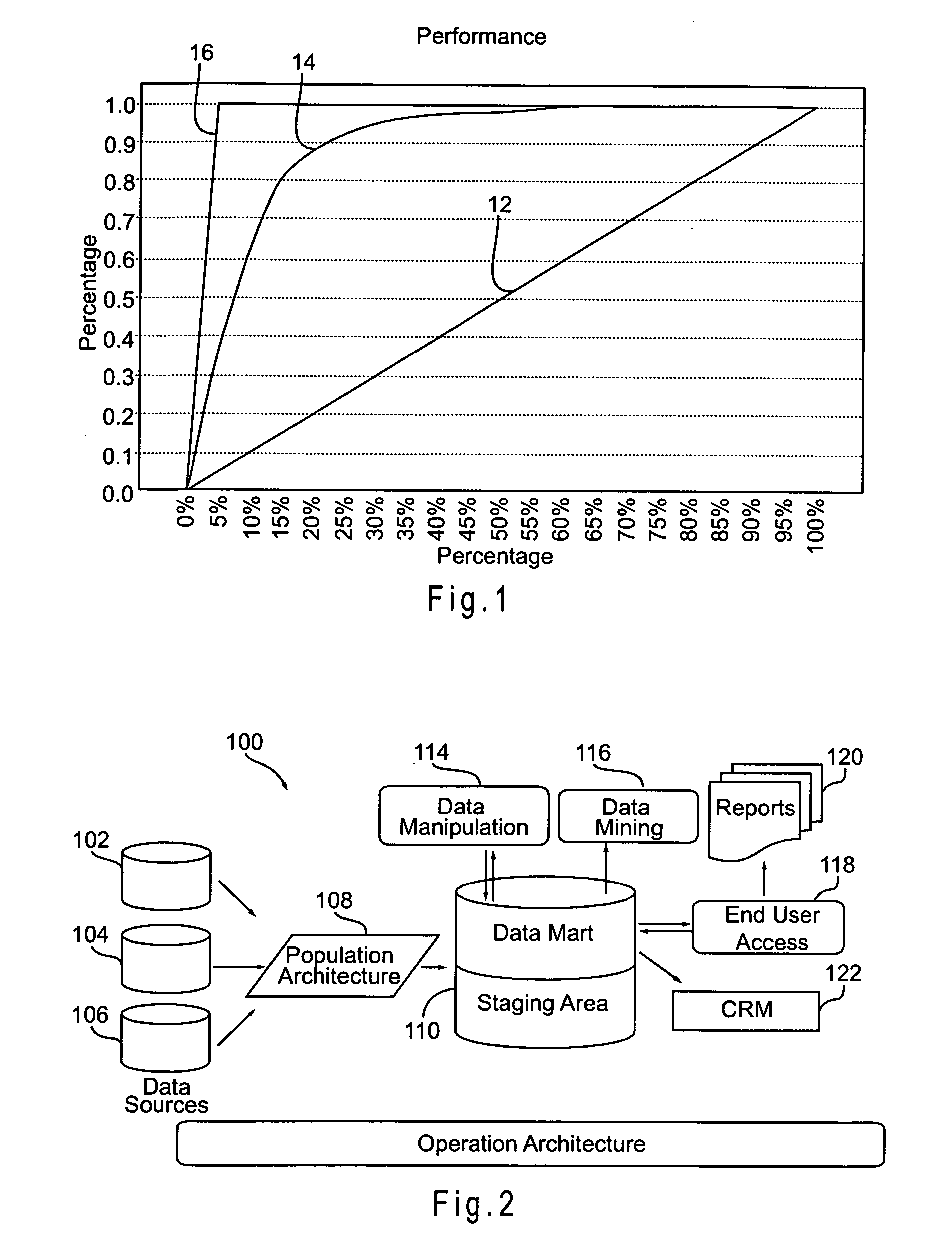

Churn prediction and management system

ActiveUS20070156673A1Avoid erosionFacilitates efforts to retain high profitability customersSpecial data processing applicationsMarketingCustomer attritionData operations

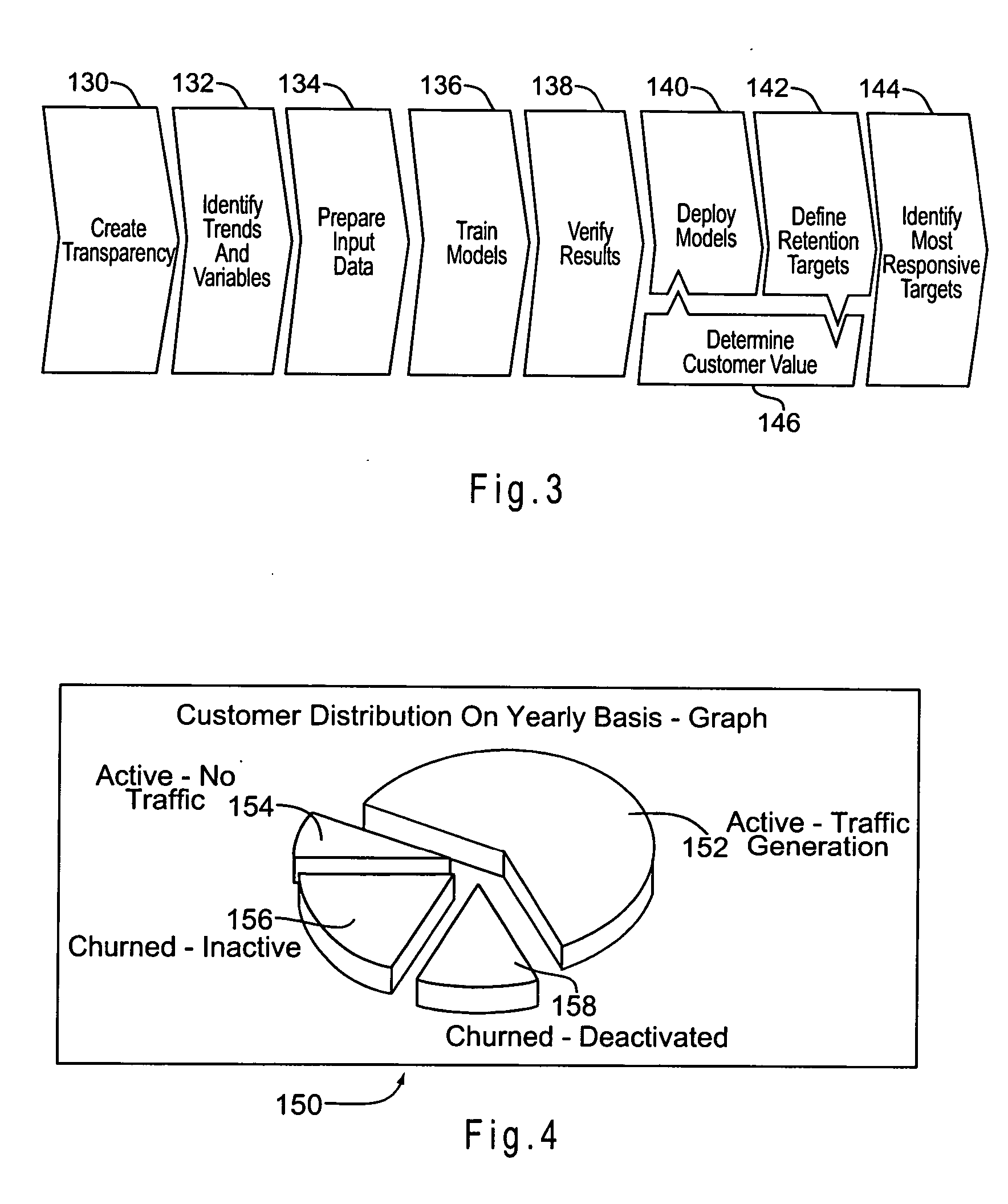

A system and method for managing churn among the customers of a business is provided. The system and method provide for an analysis of the causes of customer churn and identifies customers who are most likely to churn in the future. Identifying likely churners allows appropriate steps to be taken to prevent customers who are likely to churn from actually churning. The system included a dedicated data mart, a population architecture, a data manipulation module, a data mining tool and an end user access module for accessing results and preparing preconfigured reports. The method includes adopting an appropriate definition of churn, analyzing historical customer to identify significant trends and variables, preparing data for data mining, training a prediction model, verifying the results, deploying the model, defining retention targets, and identifying the most responsive targets.

Owner:ACCENTURE GLOBAL SERVICES LTD

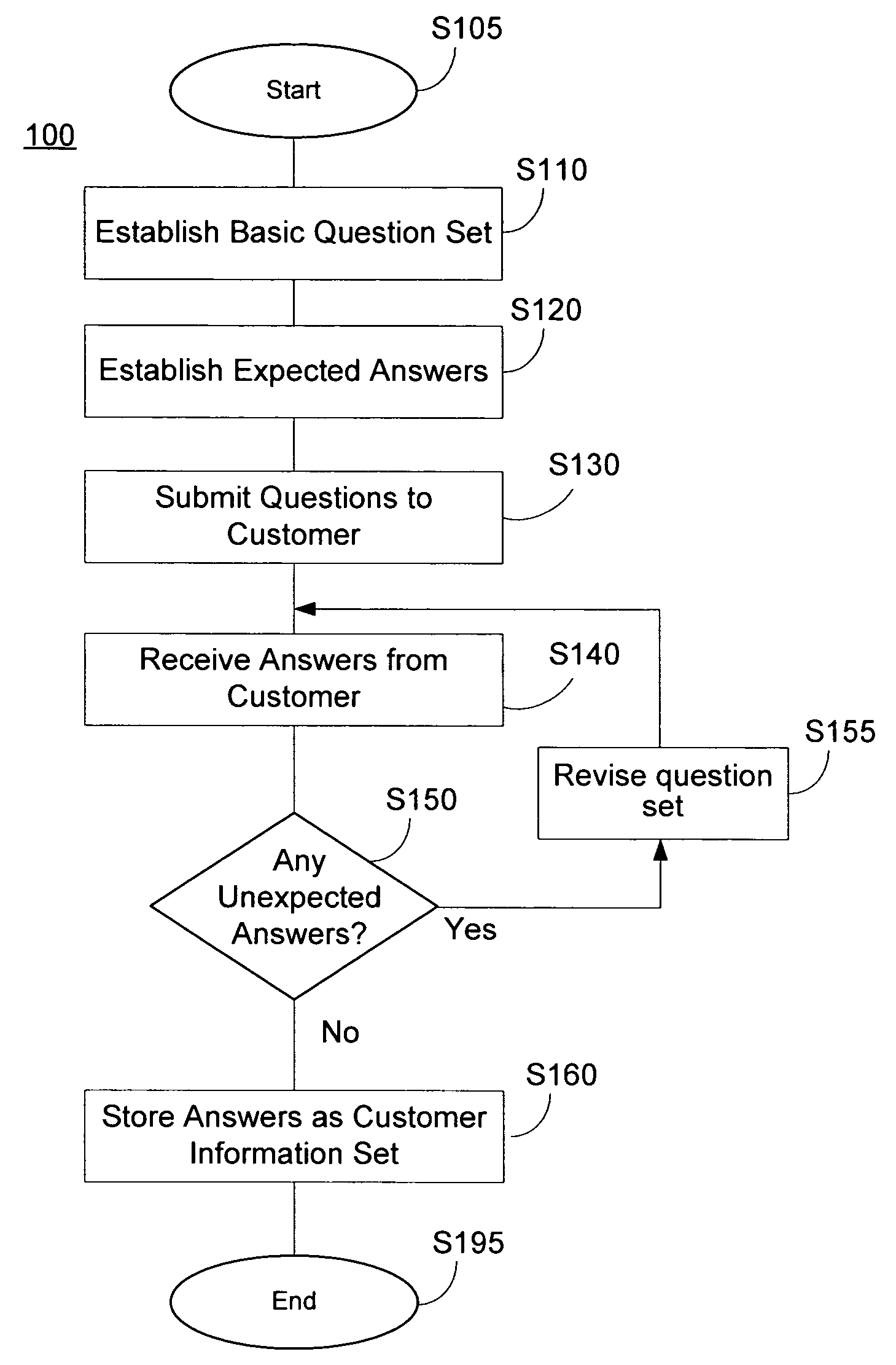

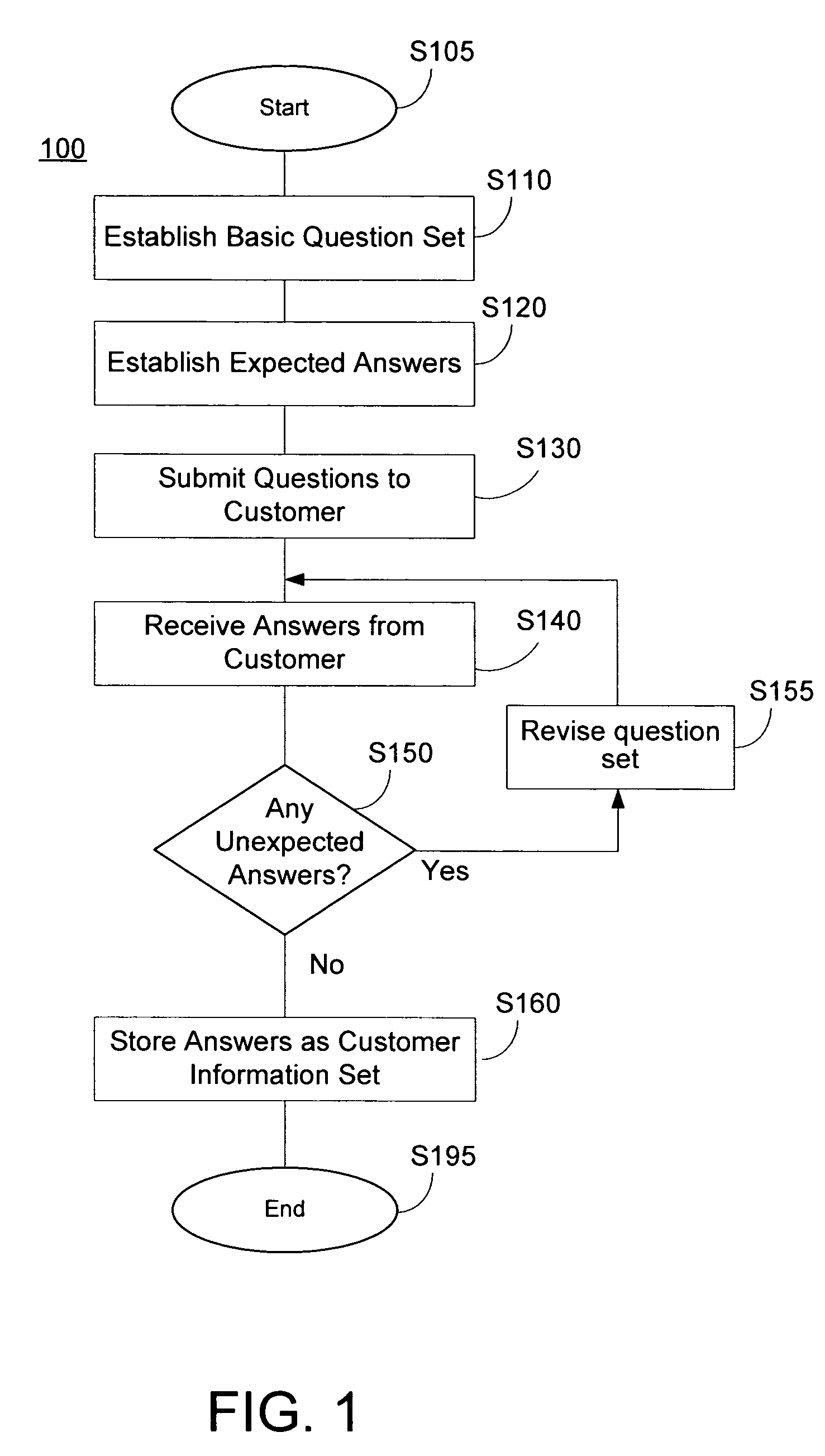

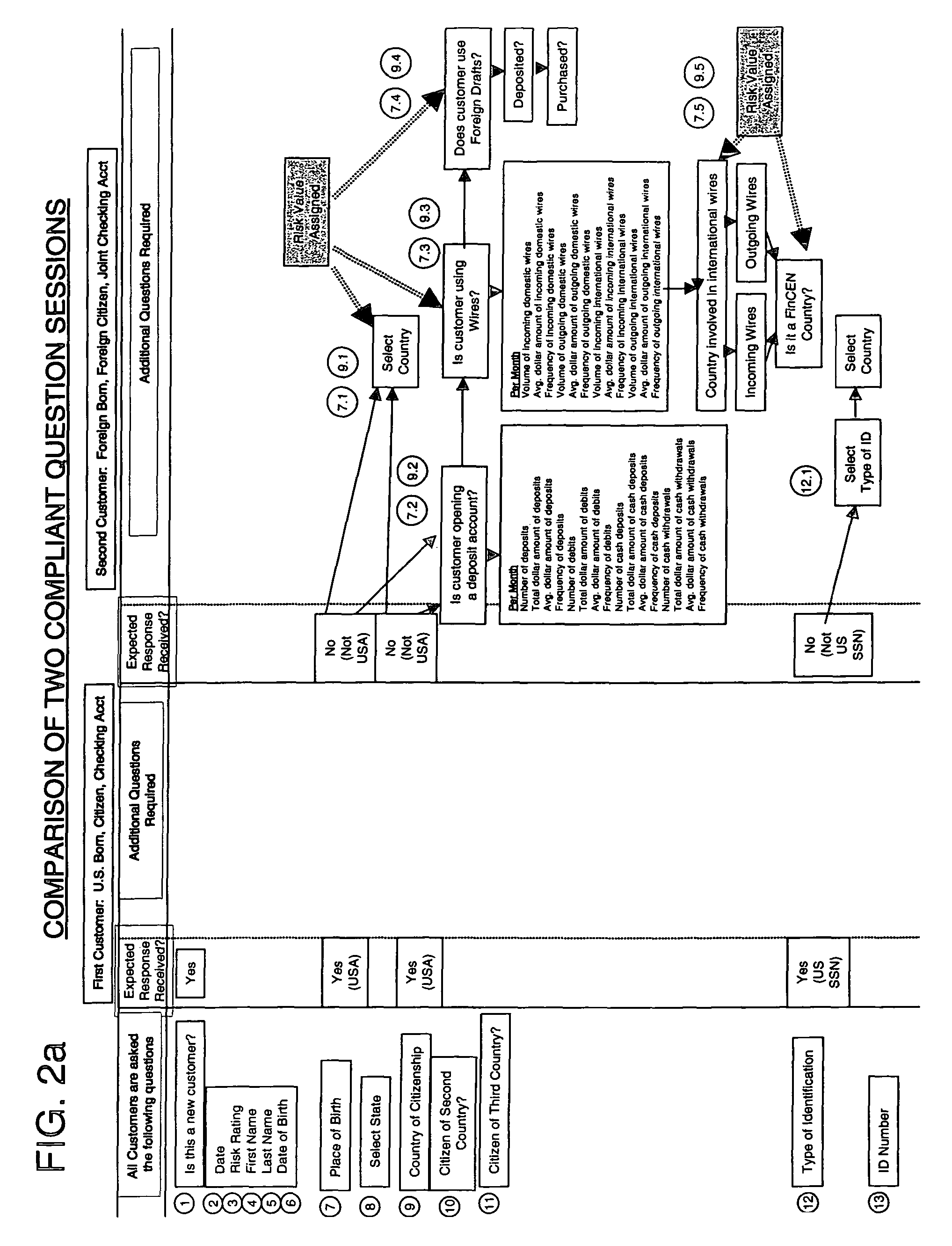

System and method for conducting an optimized customer identification program

Owner:THE PNC FINANCIAL SERVICES GROUP

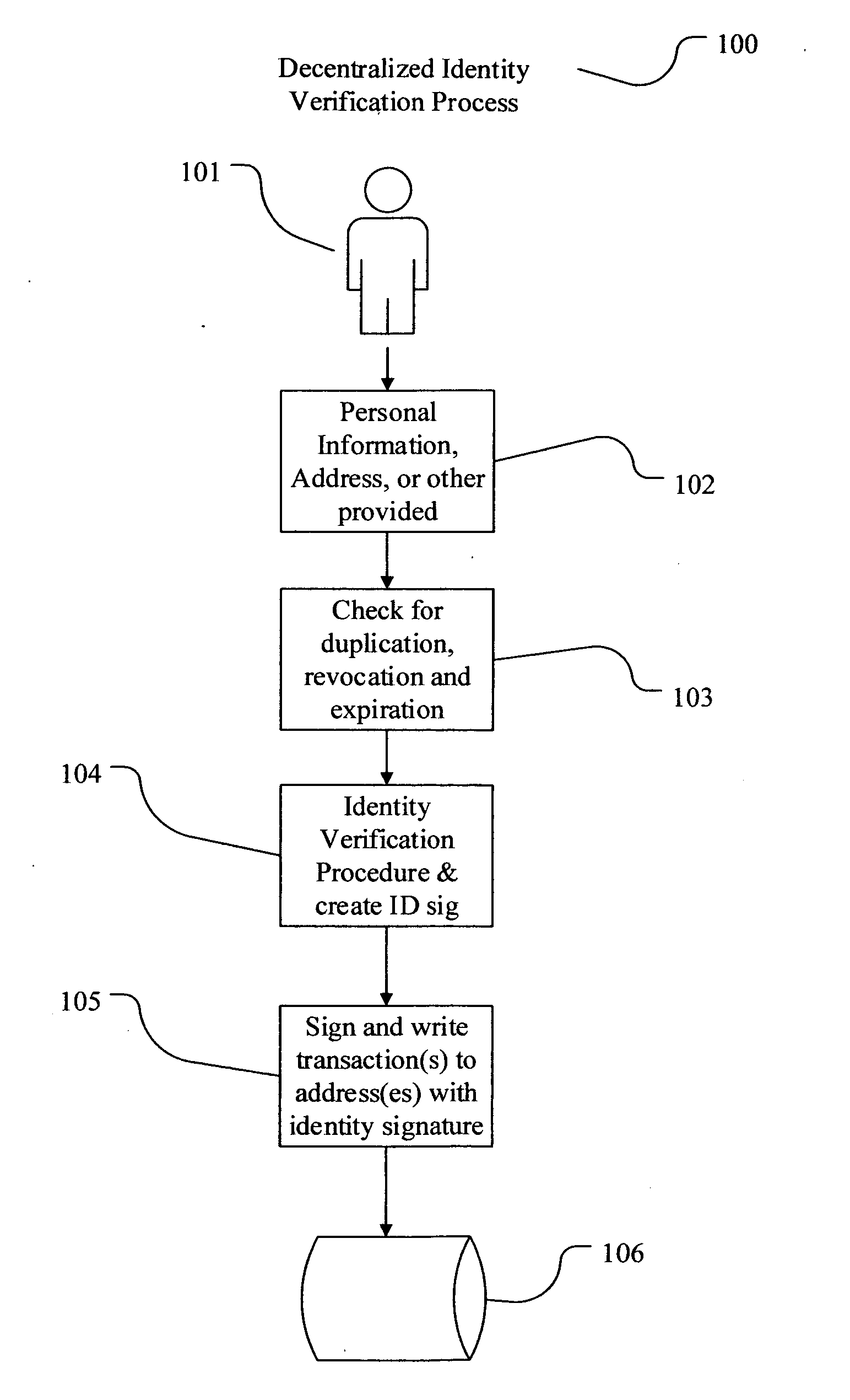

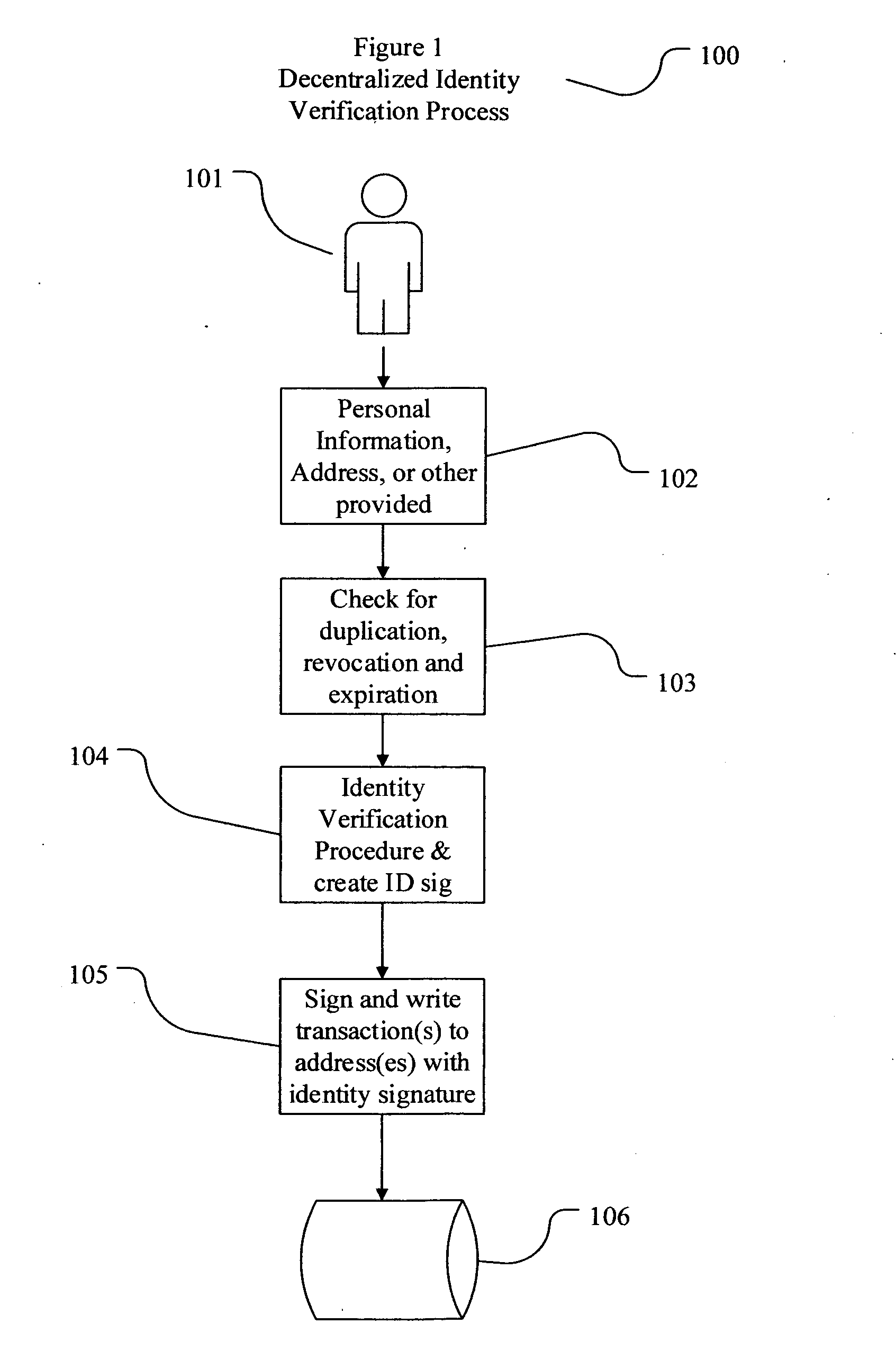

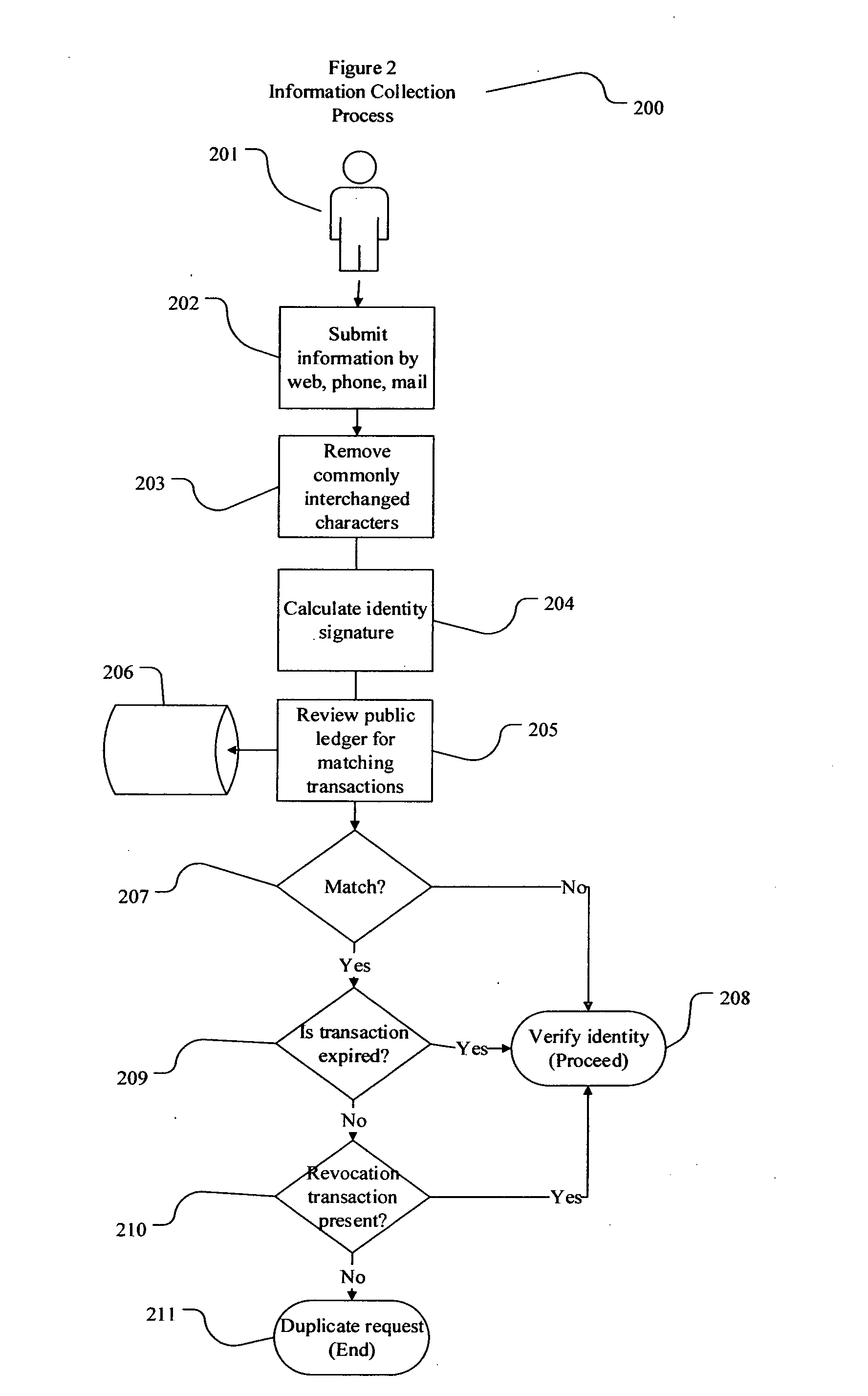

Decentralized identity verification systems and methods

InactiveUS20150356523A1Cryptography processingUser identity/authority verificationRegulatory authorityFinancial transaction

The present invention involves systems and methods that allow participants in cryptocurrency networks to exchange cryptocurrency for traditional currency legally and safely without requiring the use of a traditional exchange or online brokerage as a fiduciary. The invention accomplishes this through the use of a decentralized identity verification protocol that allows a service provider to verify the identity of a participant and then publish an identity signature on the participant's cryptocurrency address or addresses. The invention enables full compliance with Country specific customer identification program and anti-money laundering requirements, and maintains the ability to independently satisfy requests for information or data retention requirements if requested by legally authorized parties, but does not require that the participant store the private keys or access controls to their cryptocurrency on an exchange or brokerage service.The invention serves to verify a participant's identity in full compliance with US Bank Secrecy and Patriot Act provisions or similar regulations where identification may be achieved through non-documentary or documentary identity verification procedures. After passing the applicable verification procedure, the service provider stamps the participant's cryptocurrency address with a transaction containing an identity signature. This identity signature within the transaction consists of a public indicator of the participant's Country and subdivision, a compliance level code, an ID type indicator, and an identity hash. The identity hash is created from the digests of cryptographic hash functions where the participant's personal information is used as an input. The service provider signs the transaction with their authorized private key that corresponds to their publicly accessible public key. This serves as a publicly verifiable confirmation that the identity associated with the address in question was validated by the service provider authorized to act on behalf of the regulatory authority.The participant may then purchase and sell cryptographic currency from and to a third party exchange or brokerage service legally and safely when using their verified cryptocurrency address. This is because the third party is able to confirm compliance by openly referencing and verifying the identity verification transaction present on the address. Subsequent transactions where the third party sells or purchases cryptocurrency for the verified participant are similarly stamped with a transaction conforming to the identity verification protocol. This allows the third party interacting with the verified participant's address to observe any regulations limiting the amount or frequency of transactions over a variable period of time. It follows that this address could be used with any third party or participant in the cryptocurrency network that observes the decentralized identity verification protocol, all without requiring the third party or participant to collect and verify personal information redundantly. The ability to verify an identity remotely also eliminates the need for the third party to act as a fiduciary holding the private keys or access controls to the verified address. Lawful requests for information by authorized authorities are served to the service provider as digitally signed transactions that may then be linked to the participant's identity and transactions, allowing the protocol to observe subpoenas or similar lawful requests for information. The encrypted personal information may be held in escrow by the service provider indexed to the verified cryptocurrency address for such purposes. An alternate embodiment would store the encrypted personal information in a decentralized network of other participants, with the information accessible for retrieval using the public key of the verified cryptocurrency address and decryption using the corresponding private key, decentralizing the process entirely except for the identity verification step.

Owner:CHAINID

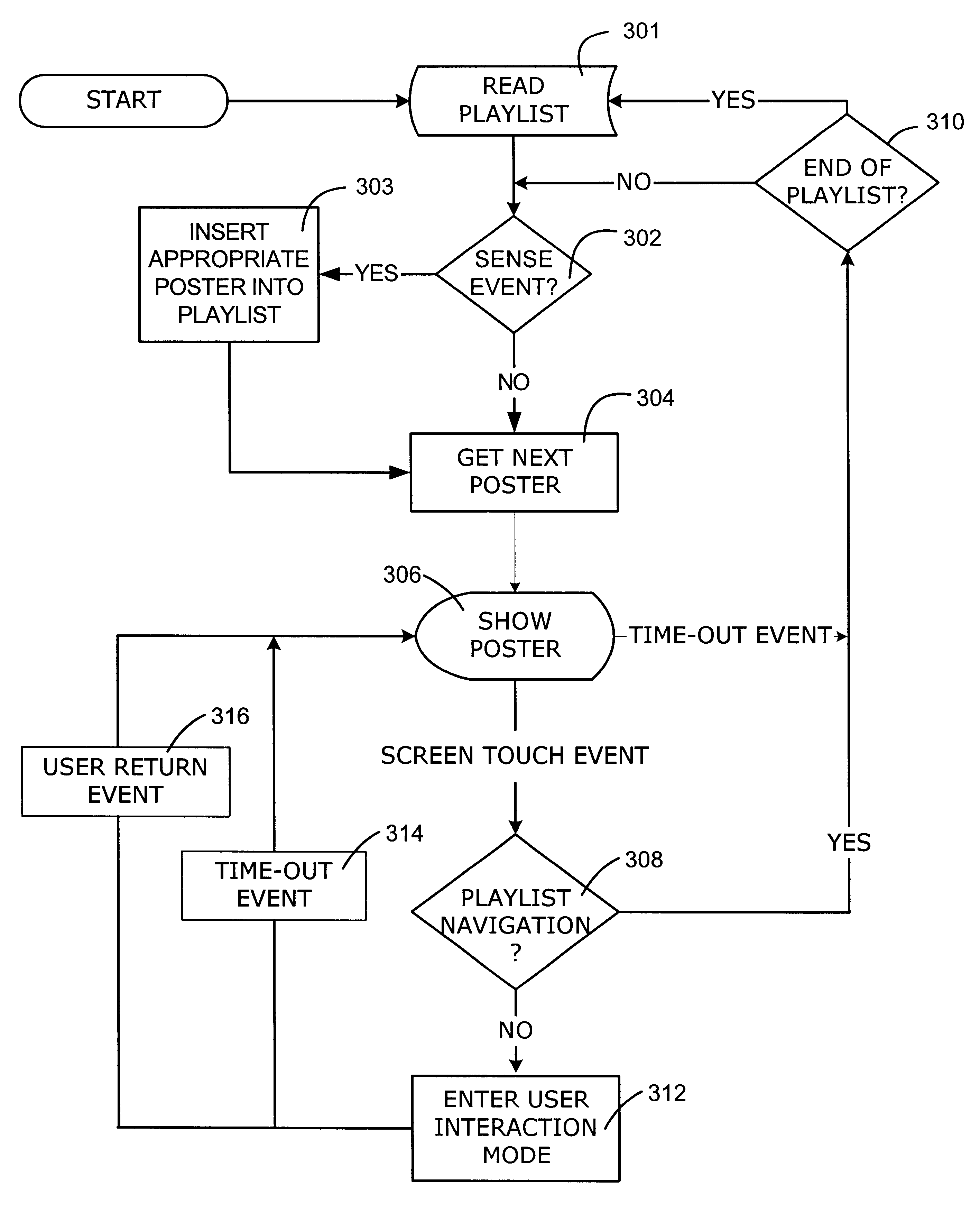

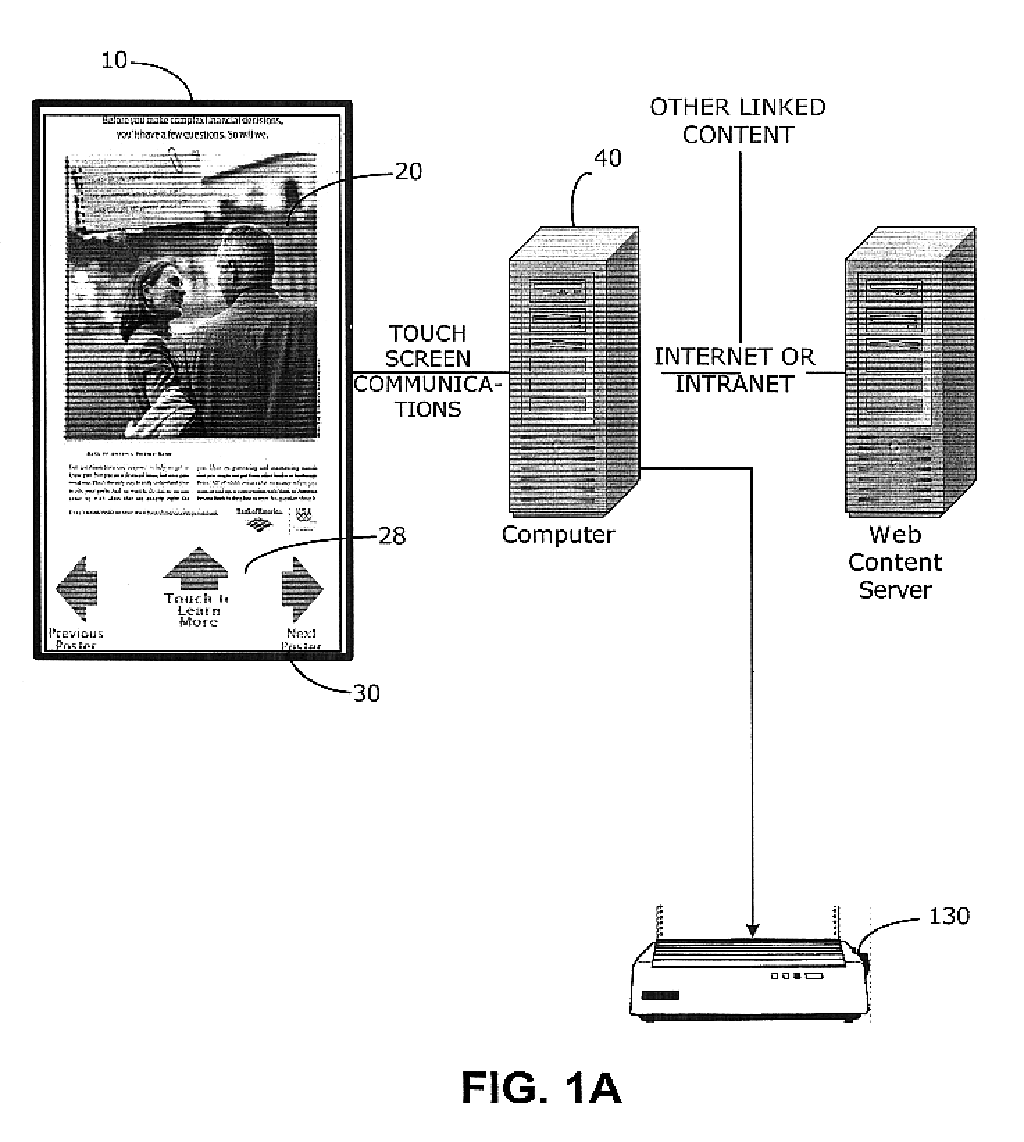

System and method for interactive advertising

InactiveUS6708176B2Attracting public attentionIncreased patronageAdvertisingCommerceDisplay deviceCustomer identification

An interactive advertising and public announcement system having storage and processing capabilities, as well as a display device, configured to store, process and / or display a media presentation. The media presentation proceeds according to a Playlist that may incorporate links to web-based content. The display device includes input devices allowing a user to interact with the media presentation and customer recognition devices for detecting the presence of and identifying the user. The system may also include video-conferencing capabilities, and the ability to detect, upload and respond to information obtained from and regarding the user. The system may also be linked and configured to retrieve and respond to user information collected from the user while the user interacts with the system, as well as user information previously-collected and stored in local or remote databases.

Owner:BANK OF AMERICA CORP

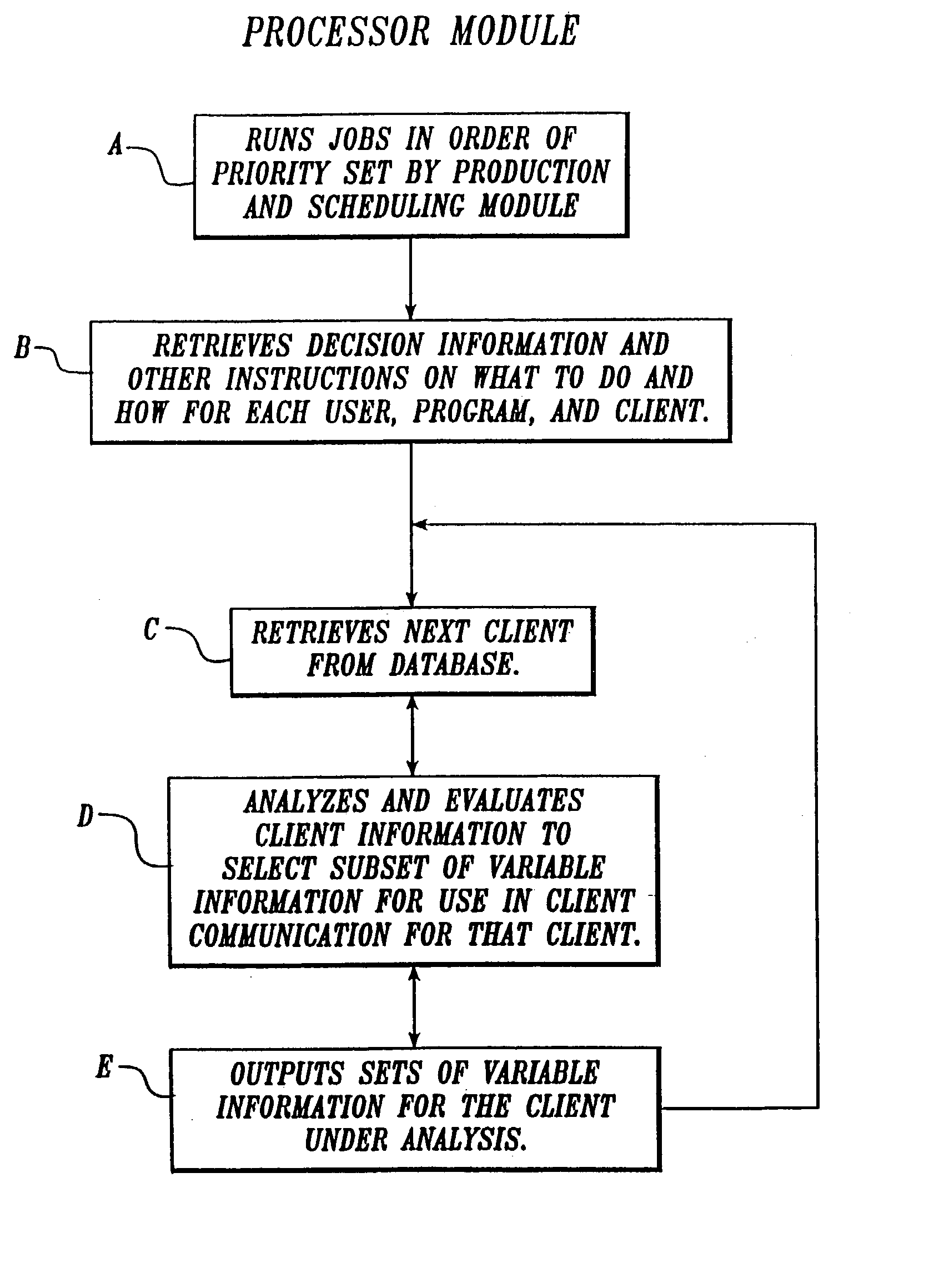

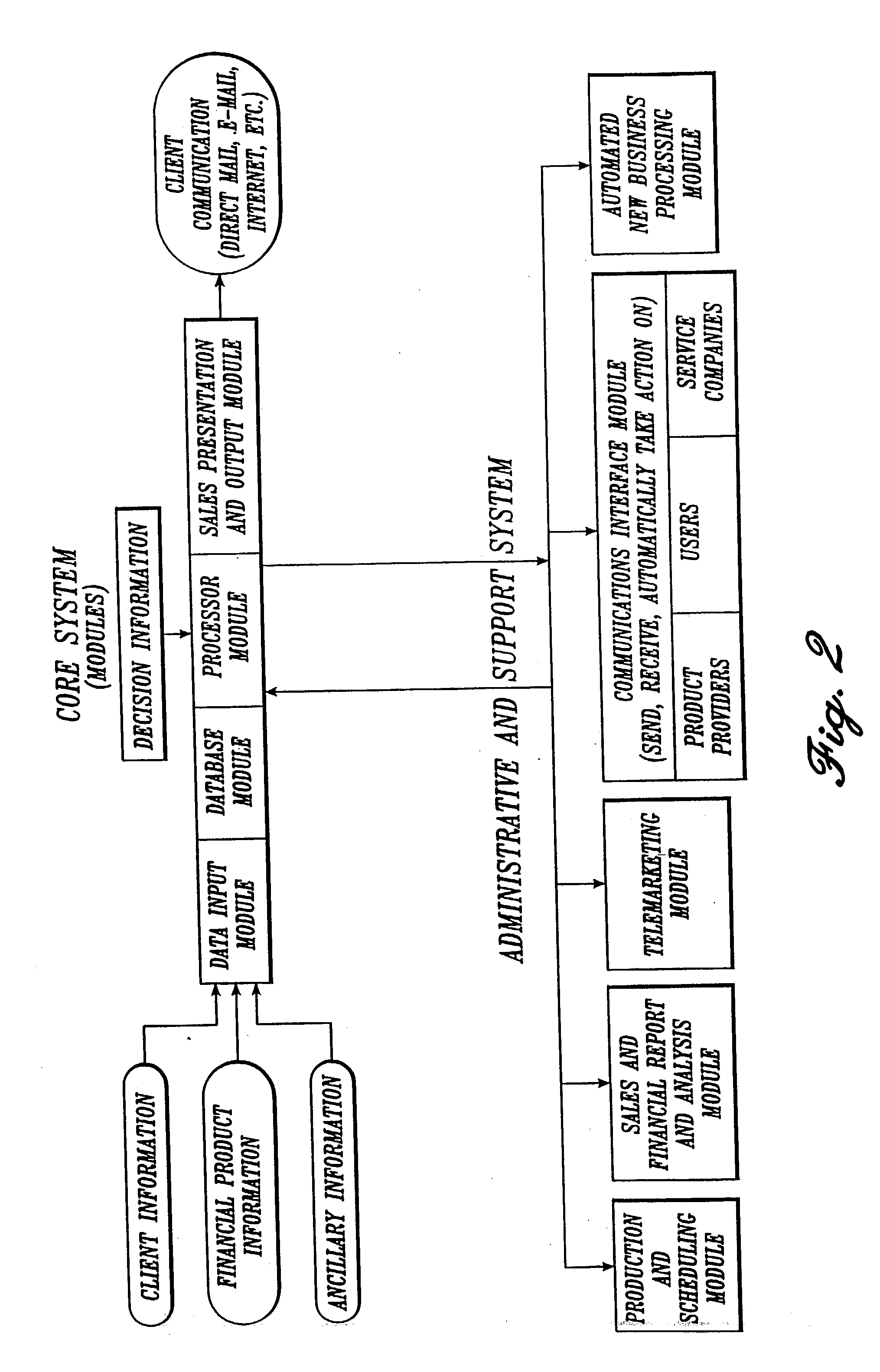

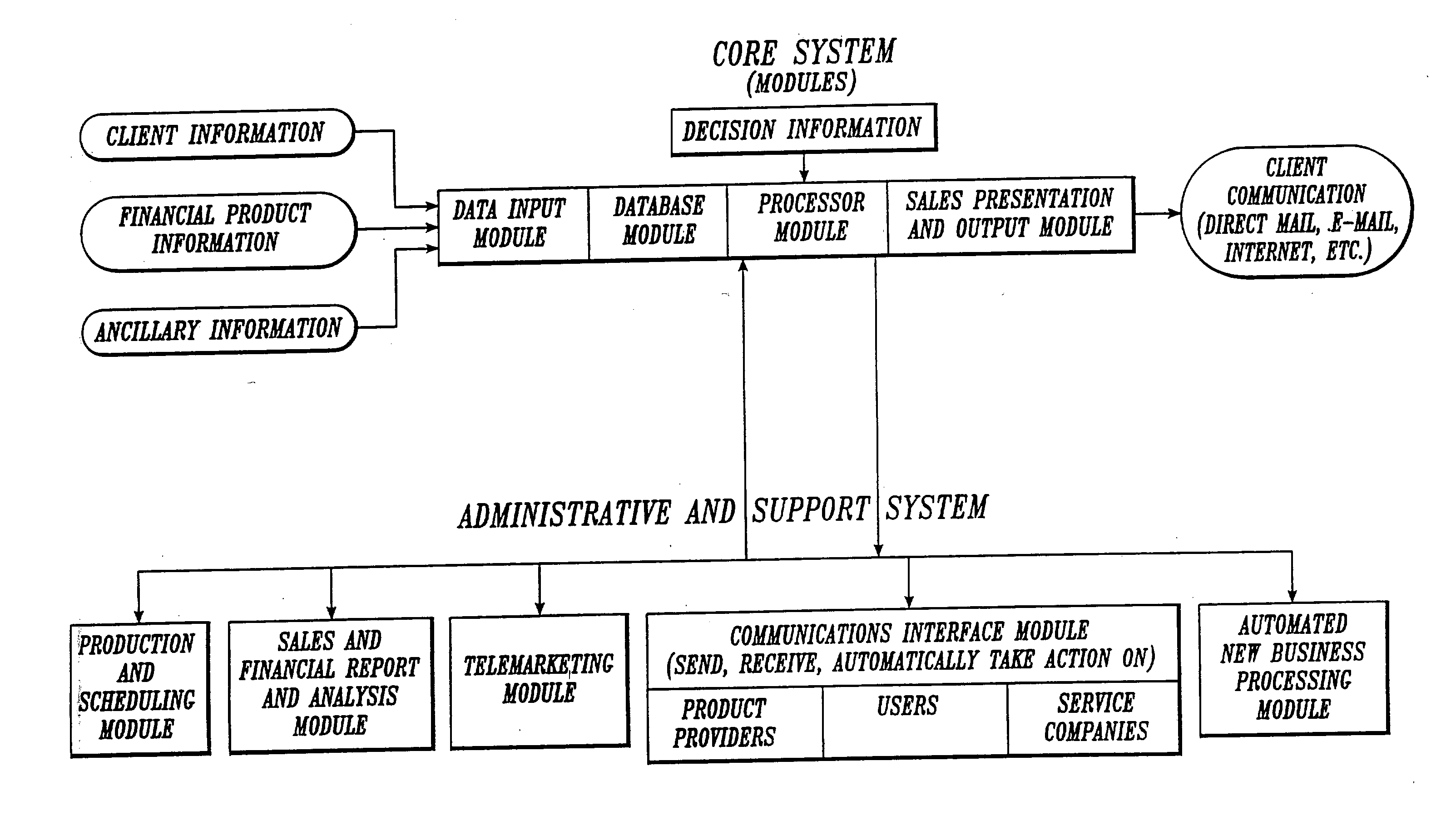

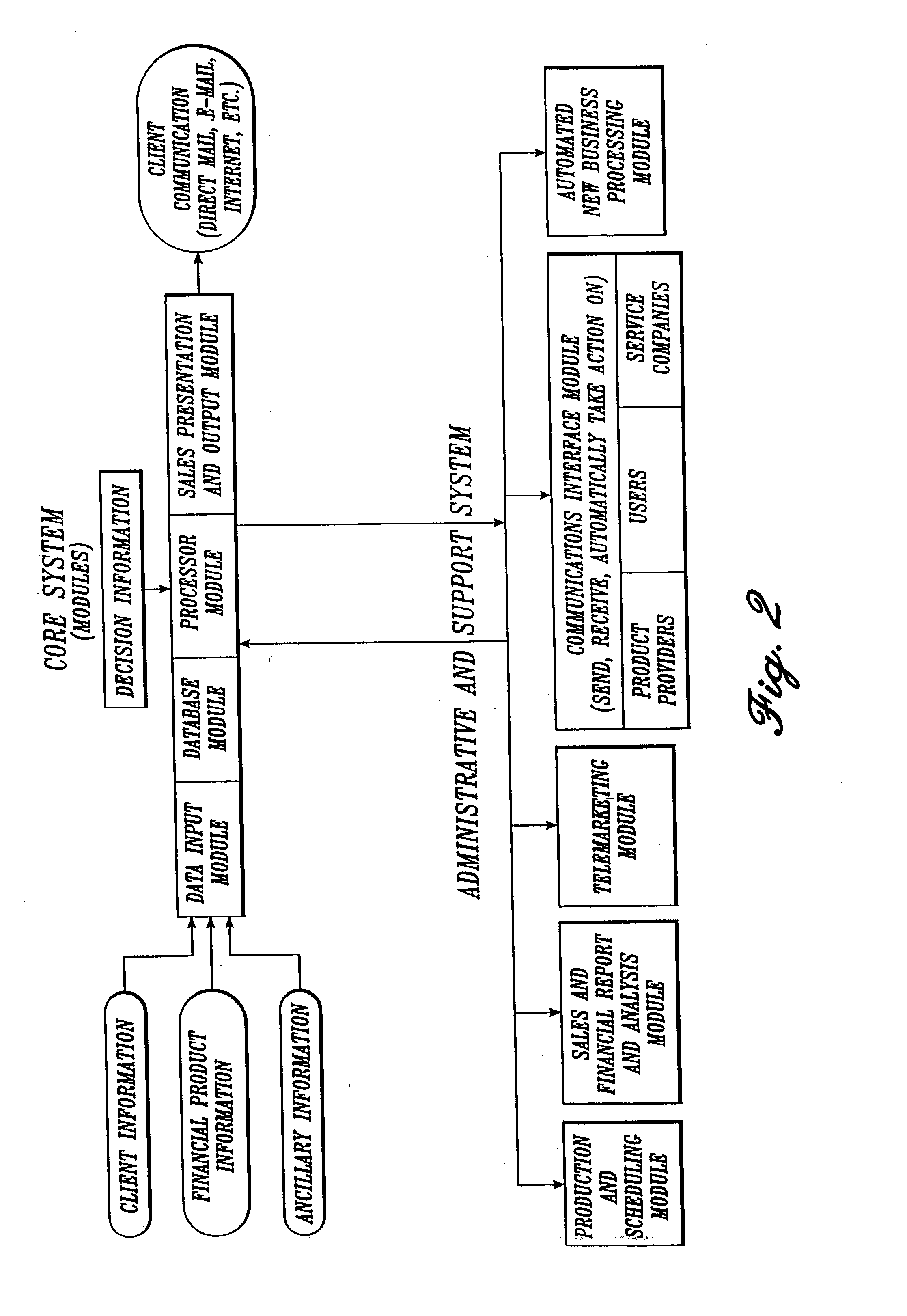

System, method, and computer program product for selecting and presenting financial products and services

InactiveUS20030216965A1Great effortGreat expenseMarket predictionsDiscounts/incentivesCombined useClient-side

A method and apparatus are provided for automatically preparing a client communication pertaining to a financial product for a client, wherein the client communication is for combined use with a corresponding host vehicle. The method comprises providing a format for the client communication wherein the communication format includes a variable portion; inputting into a computer-accessible storage medium variable information other than a client identification; inputting into the storage medium decision information; and using the decision information to select a subset of the variable information for inclusion in a variable portion of the client communication corresponding to the variable portion of the client communication format. The apparatus comprises an inputting device for inputting into a computer-accessible storage medium variable information comprising other than a client identification and decision information; a processor operatively coupled to the storage medium for using the decision information to automatically select a subset of the variable information for each of the clients; and an output preparing component in operative communication with the processor for preparing the client communications and for automatically inserting into the client communication the subset of variable information for the corresponding and respective client.

Owner:PHOENIX LICENSING

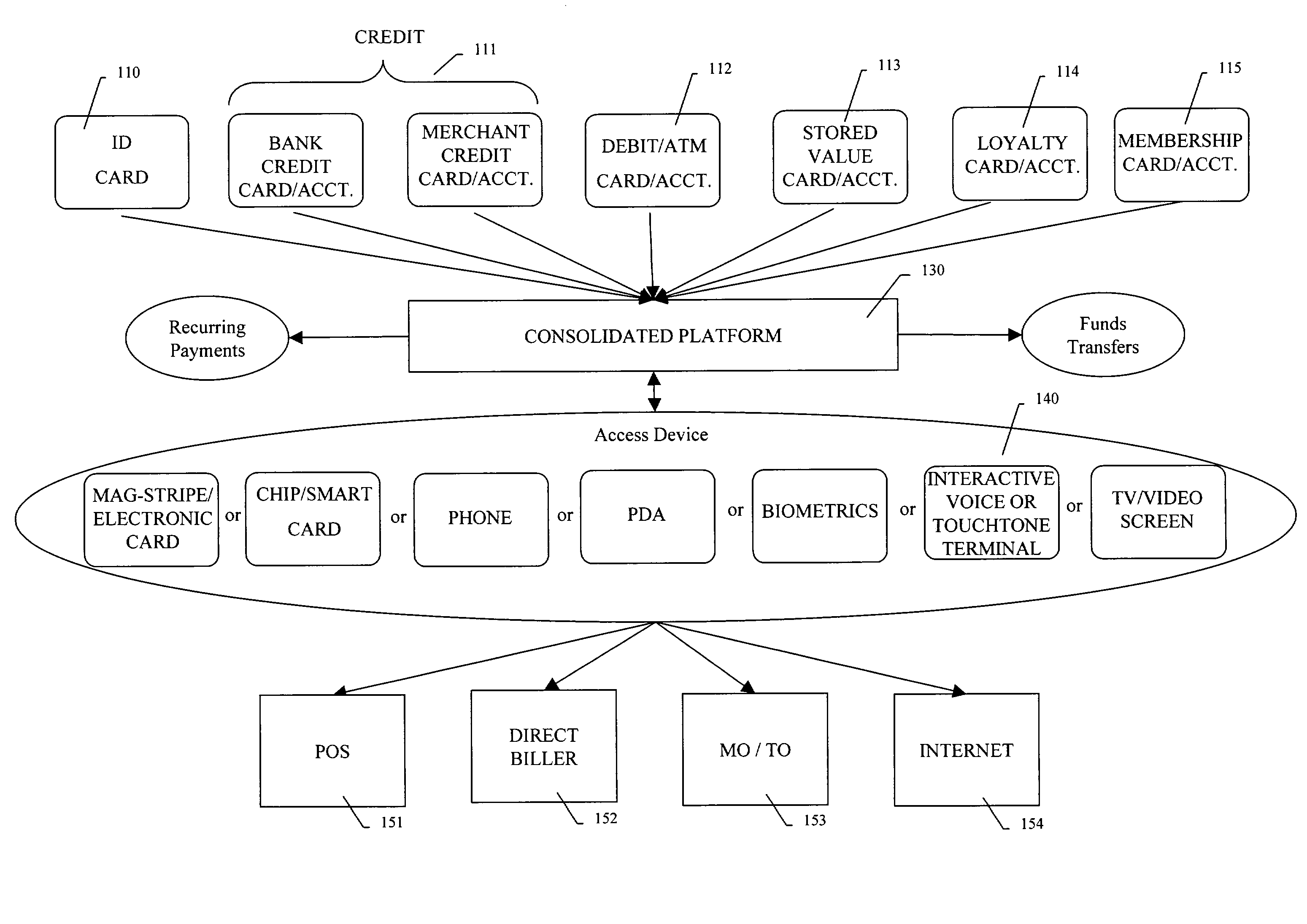

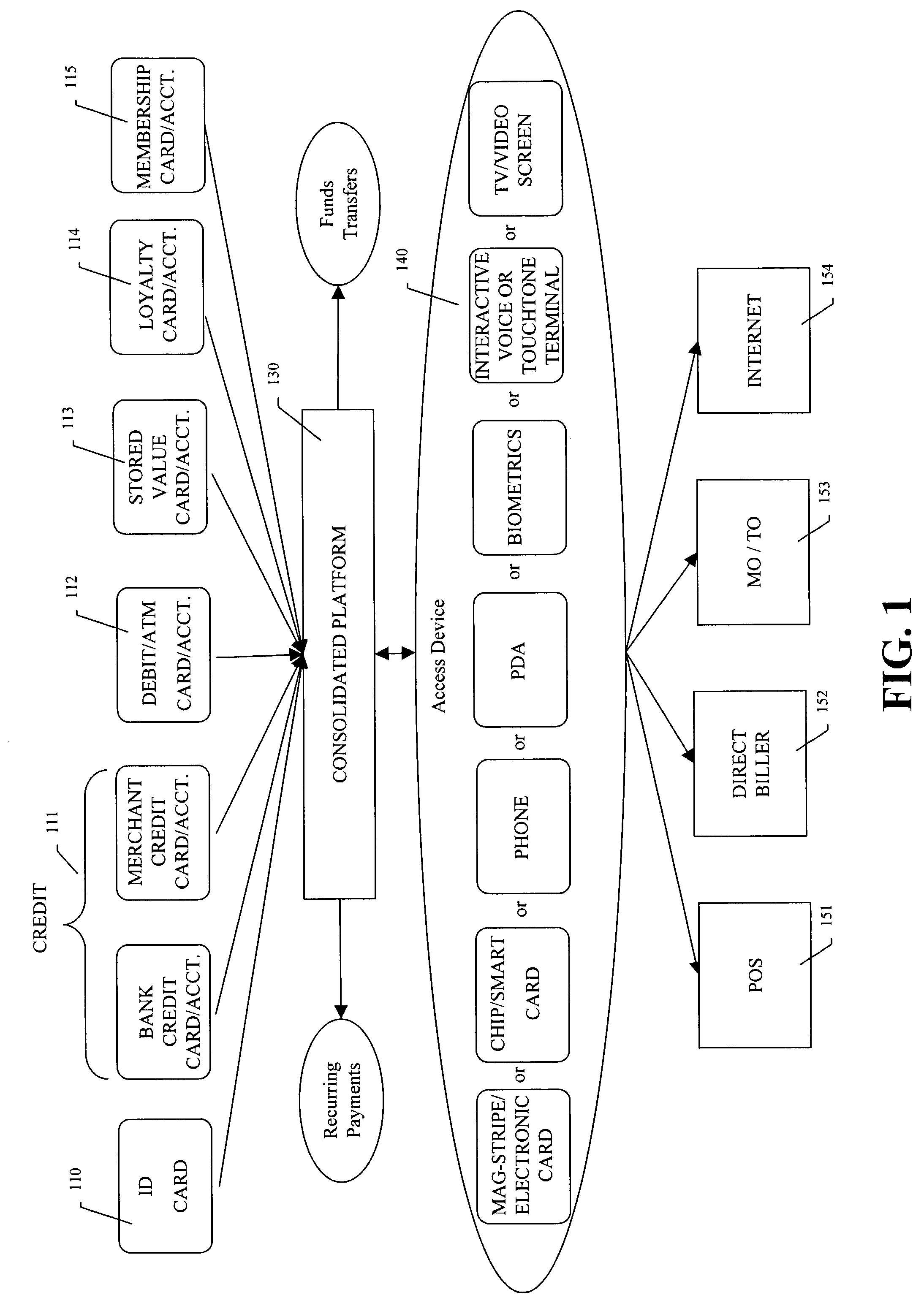

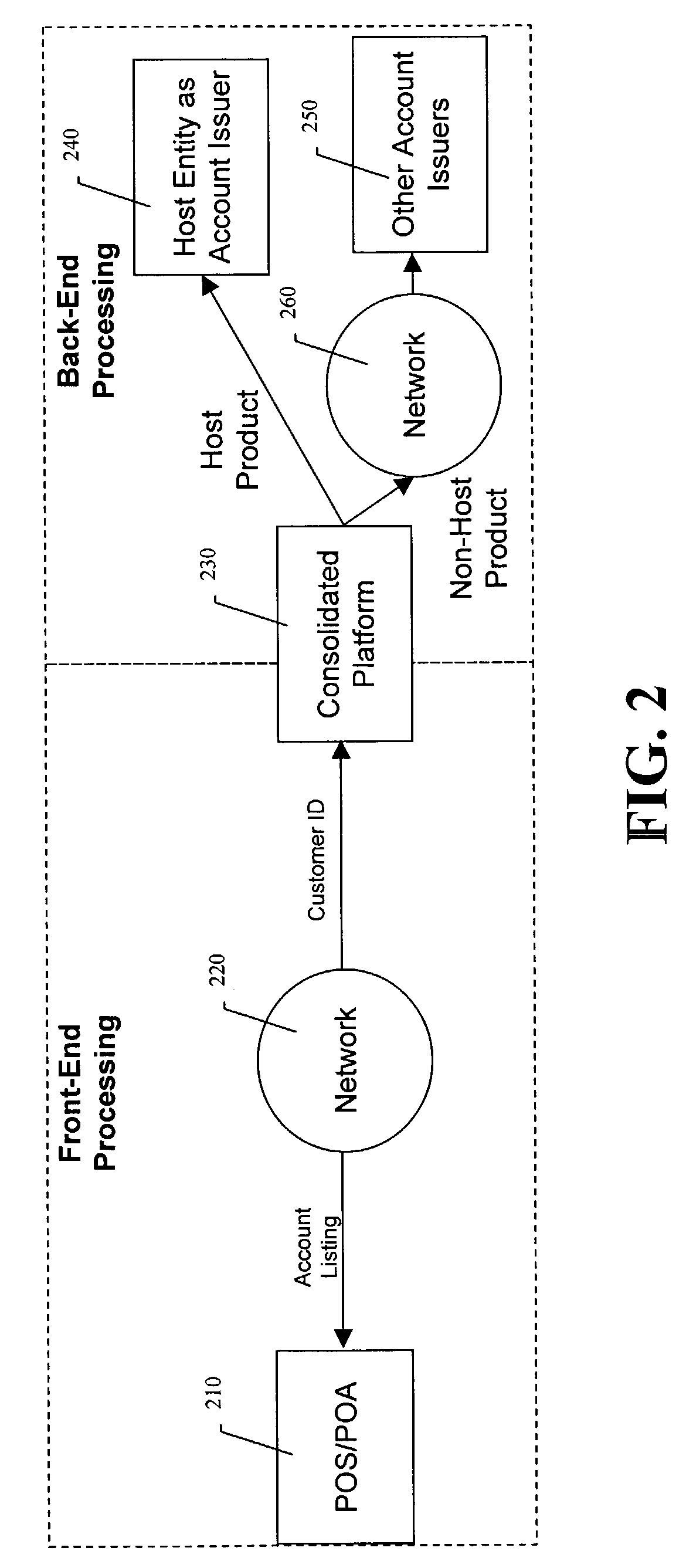

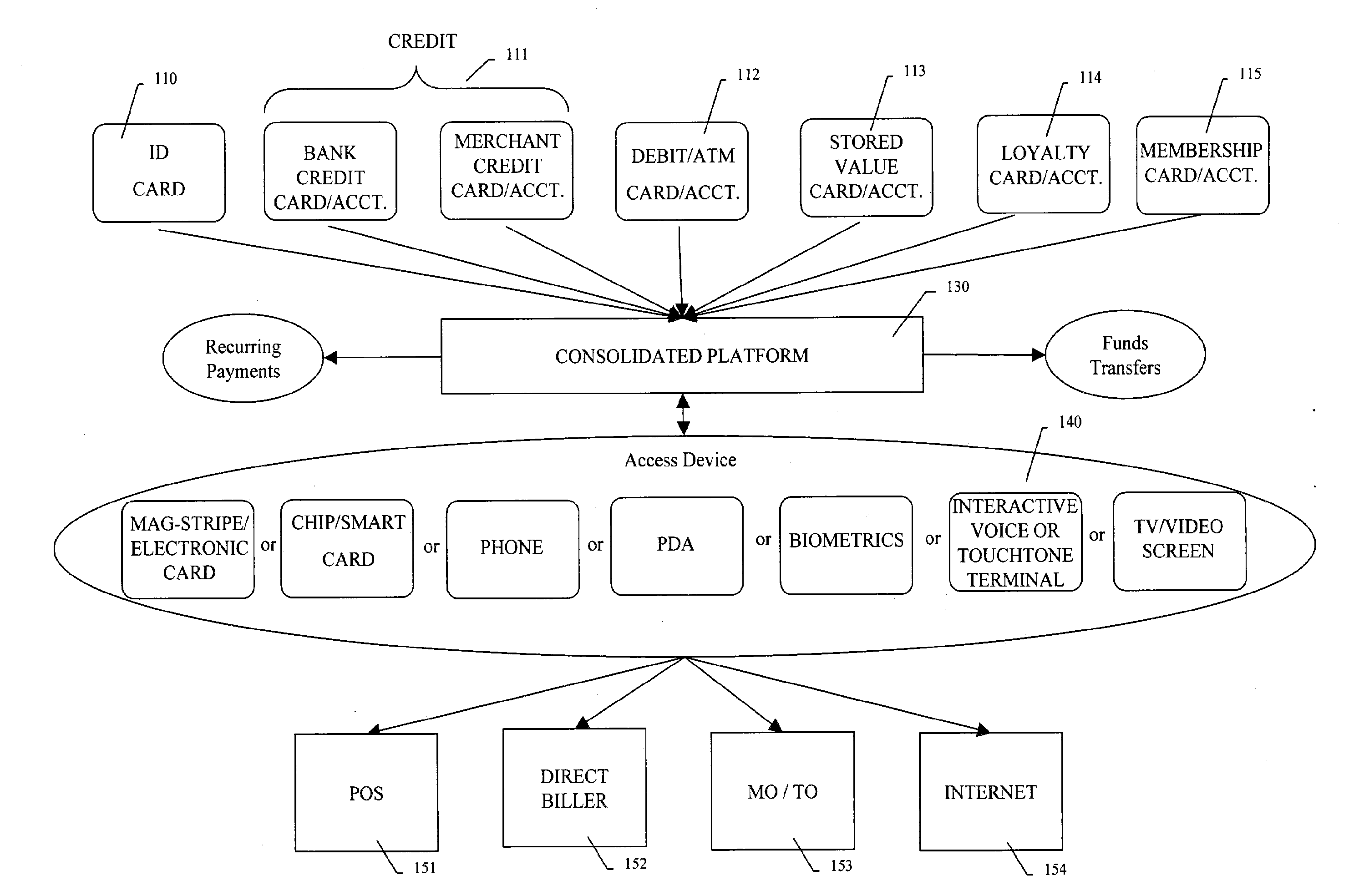

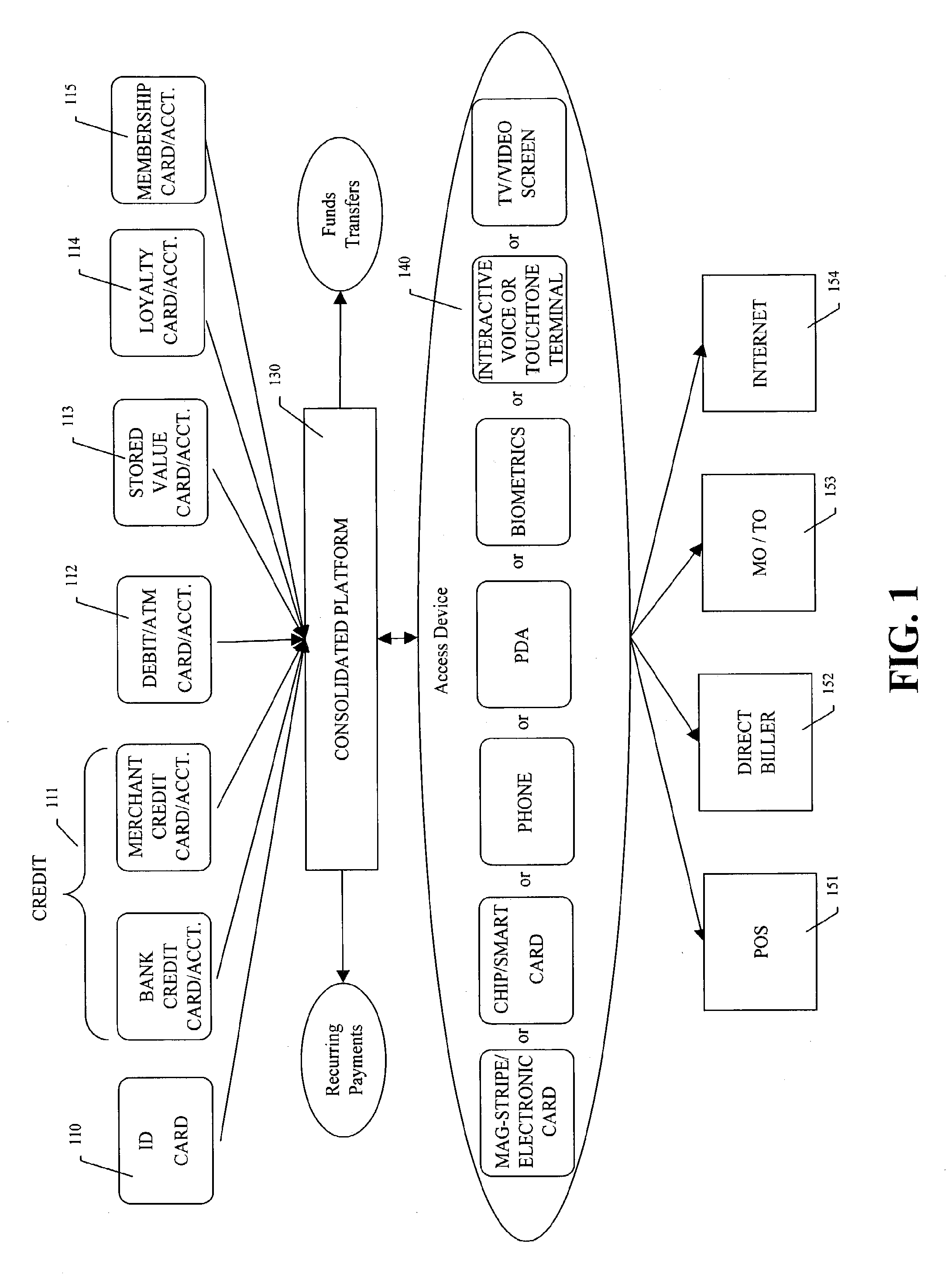

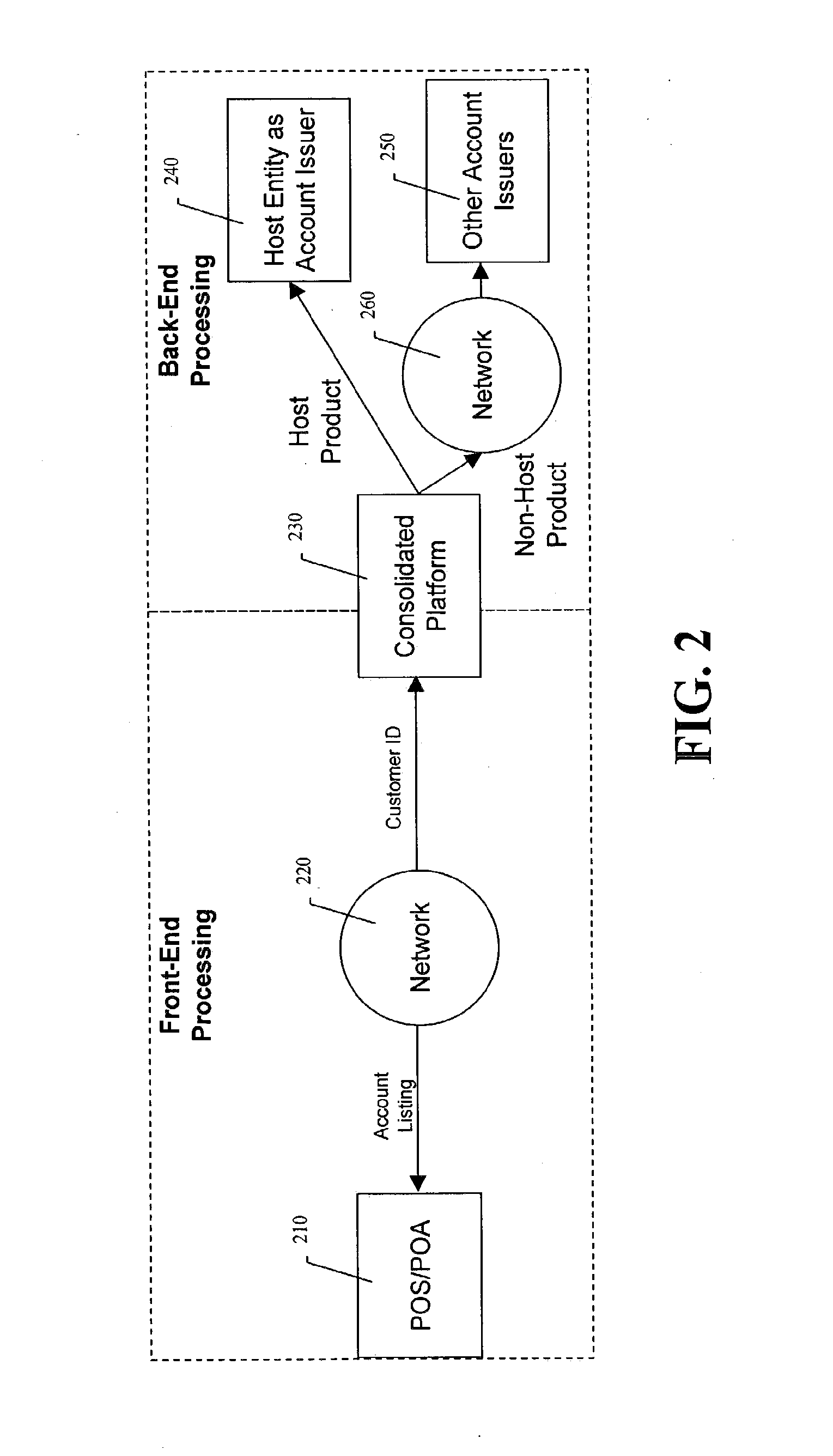

Method and system for a multi-purpose transactional platform

ActiveUS8412623B2Easy to manageEliminate needFinancePayment protocolsComputer networkComputer science

The present invention relates particularly to a method and system for consolidating a plurality of a consumer's payment and non-payment source accounts into a consolidated platform with a customer identification or available proxy account numbers that can be assigned to source accounts. The source accounts can be, for example, credit card accounts, ATM accounts, debit card accounts, demand deposit accounts, stored-value accounts, merchant-loyalty card accounts, membership accounts, and identification card numbers. The consumer can access and modify any of the source accounts and manage funds across the source accounts by accessing the consolidated platform with a single access device or mode.

Owner:CITICORP CREDIT SERVICES INC (USA)

Method and System for a Multi-Purpose Transactional Platform

InactiveUS20130218698A1Easy to manageEliminate needHand manipulated computer devicesFinanceComputer networkCustomer identification

The present invention relates particularly to a method and system for consolidating a plurality of a consumer's payment and non-payment source accounts into a consolidated platform with a customer identification or available proxy account numbers that can be assigned to source accounts. The source accounts can be, for example, credit card accounts, ATM accounts, debit card accounts, demand deposit accounts, stored-value accounts, merchant-loyalty card accounts, membership accounts, and identification card numbers. The consumer can access and modify any of the source accounts and manage funds across the source accounts by accessing the consolidated platform with a single access device or mode.

Owner:CITICORP CREDIT SERVICES INC (USA)

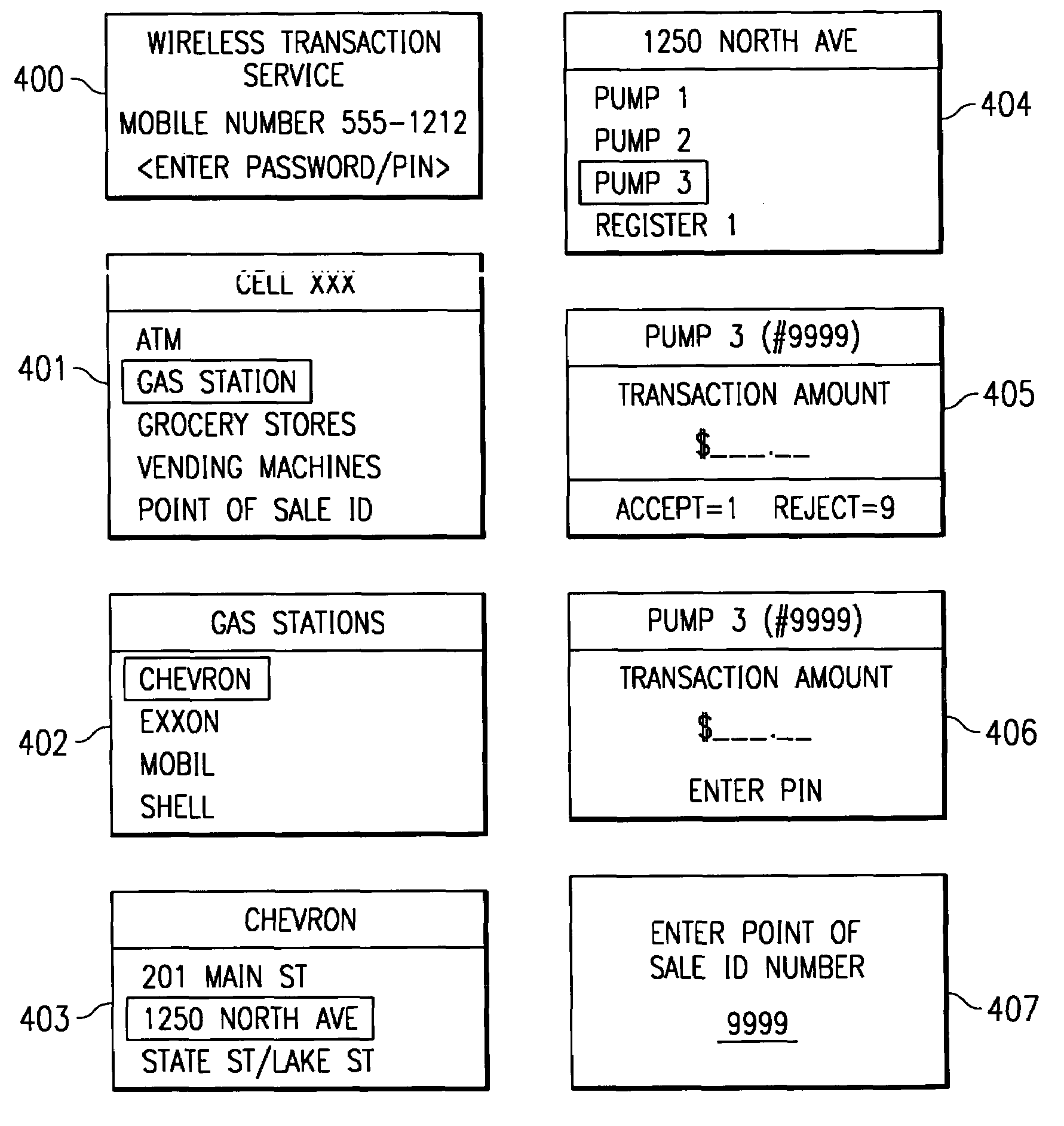

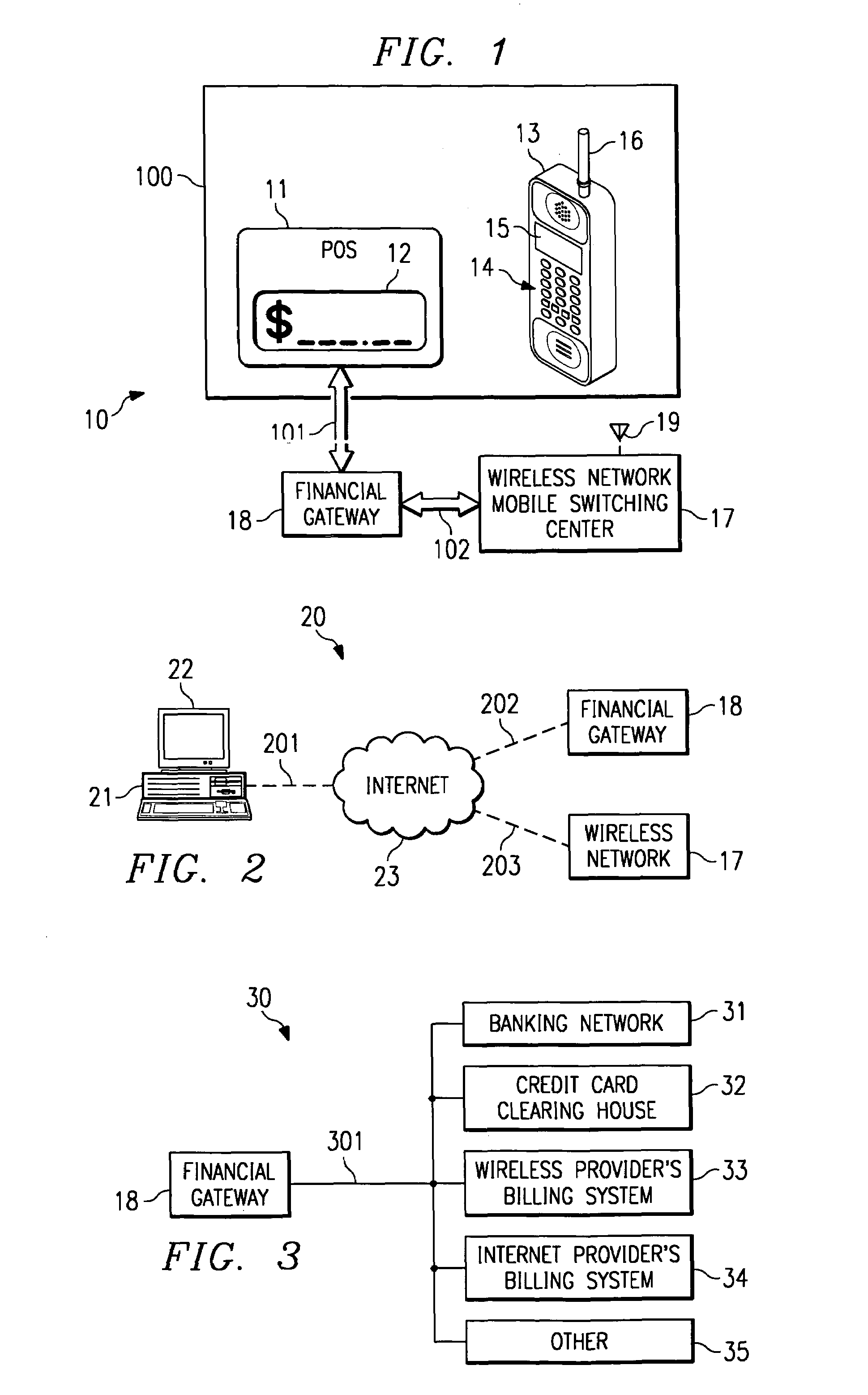

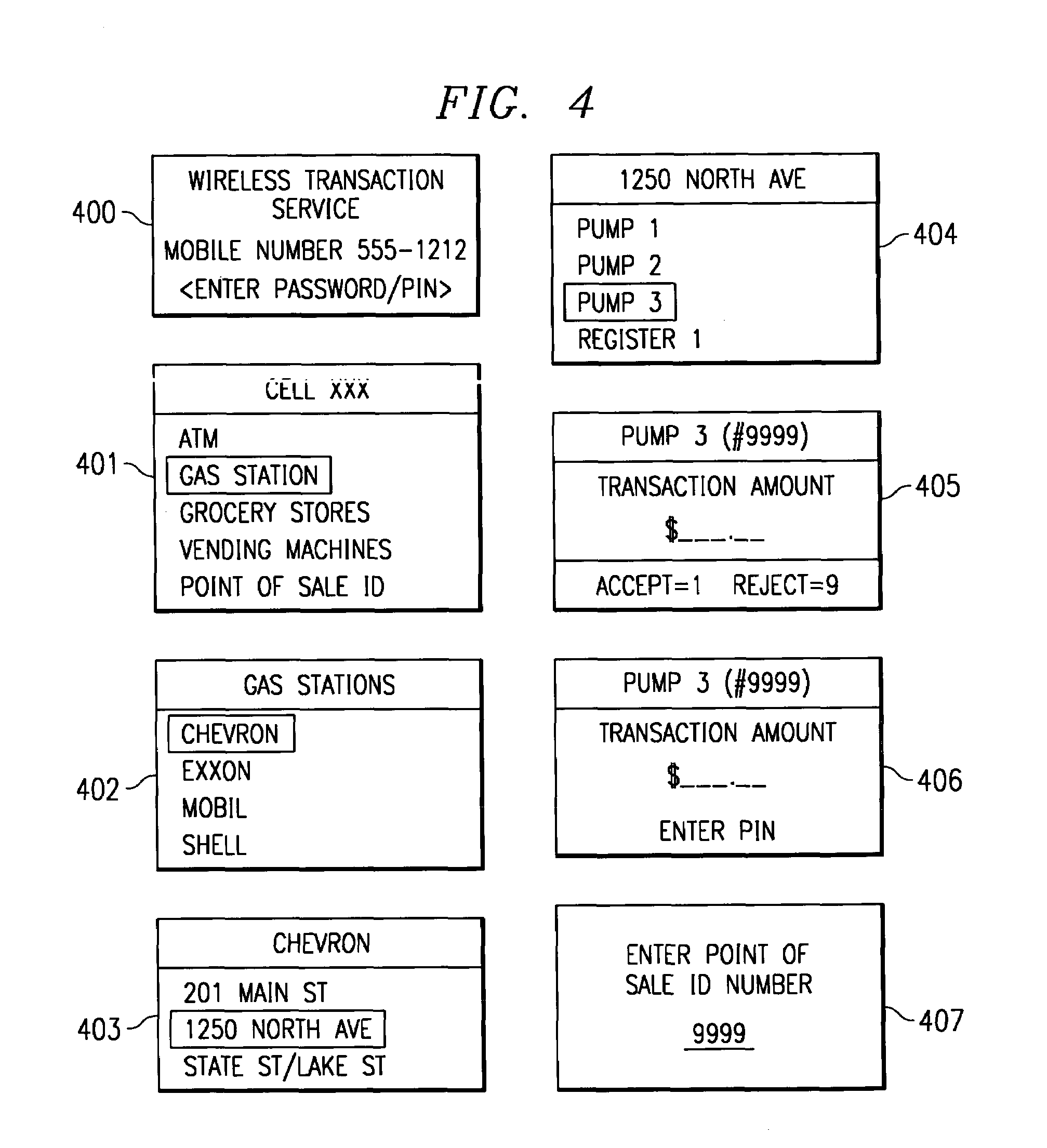

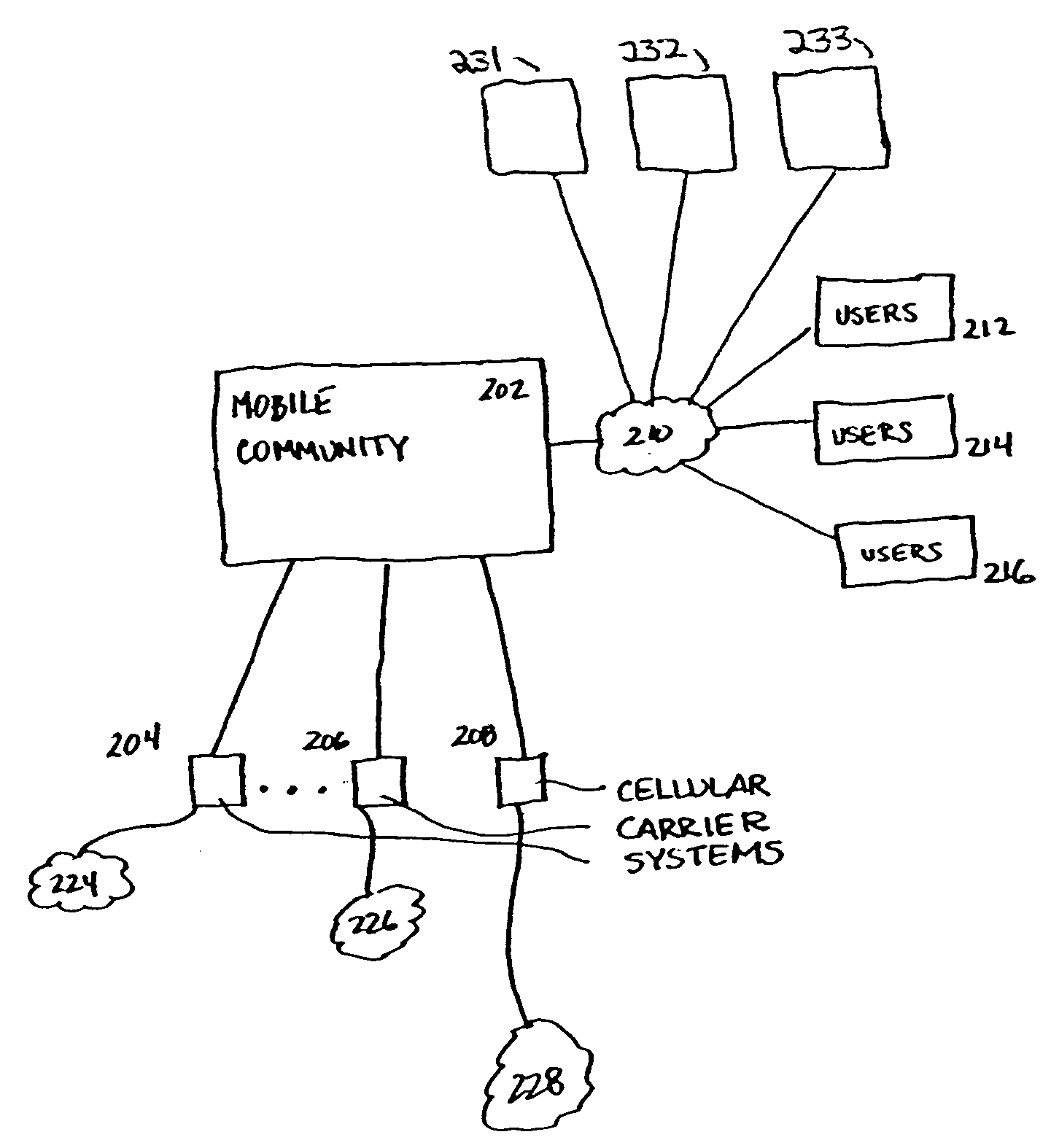

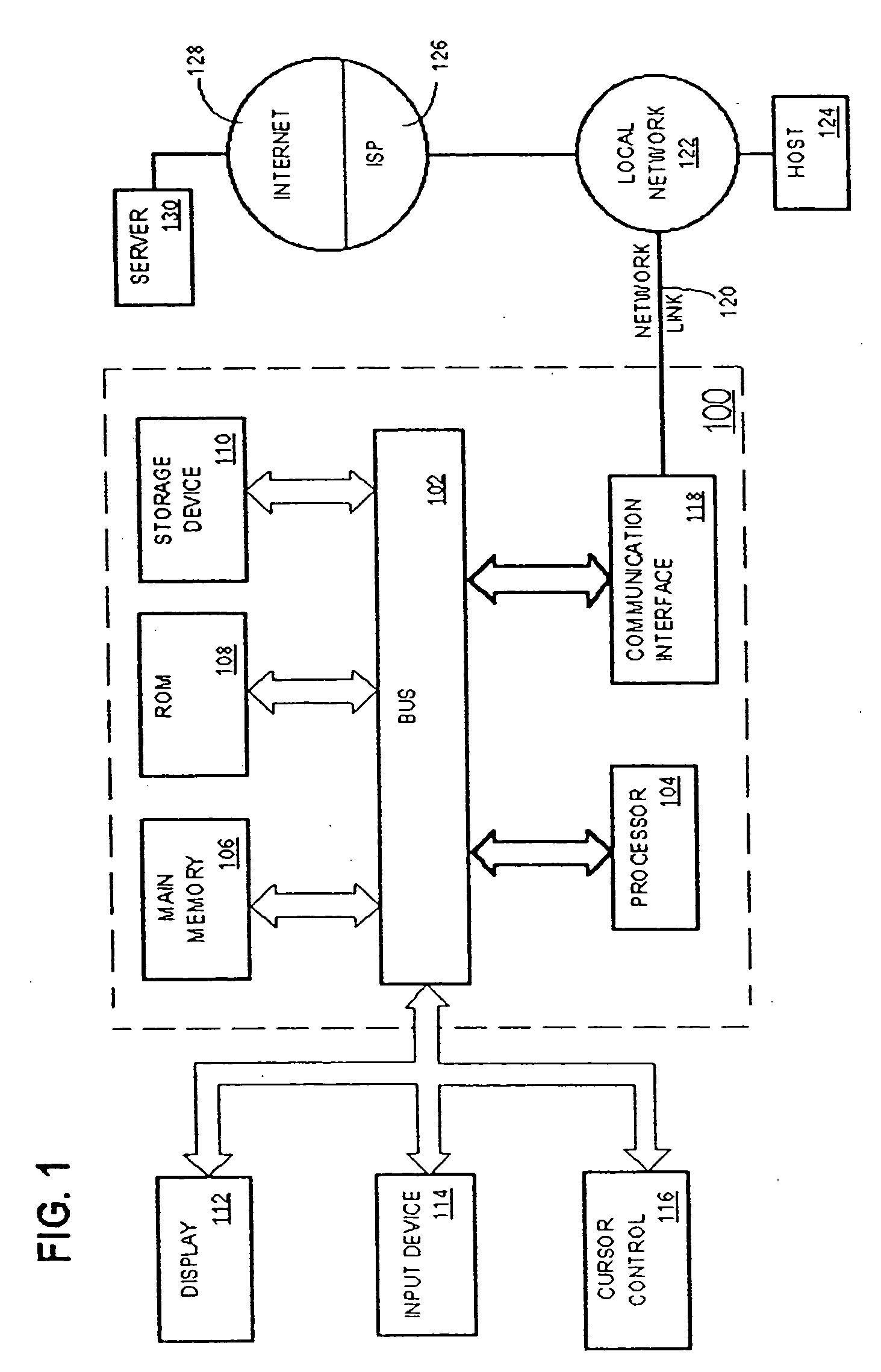

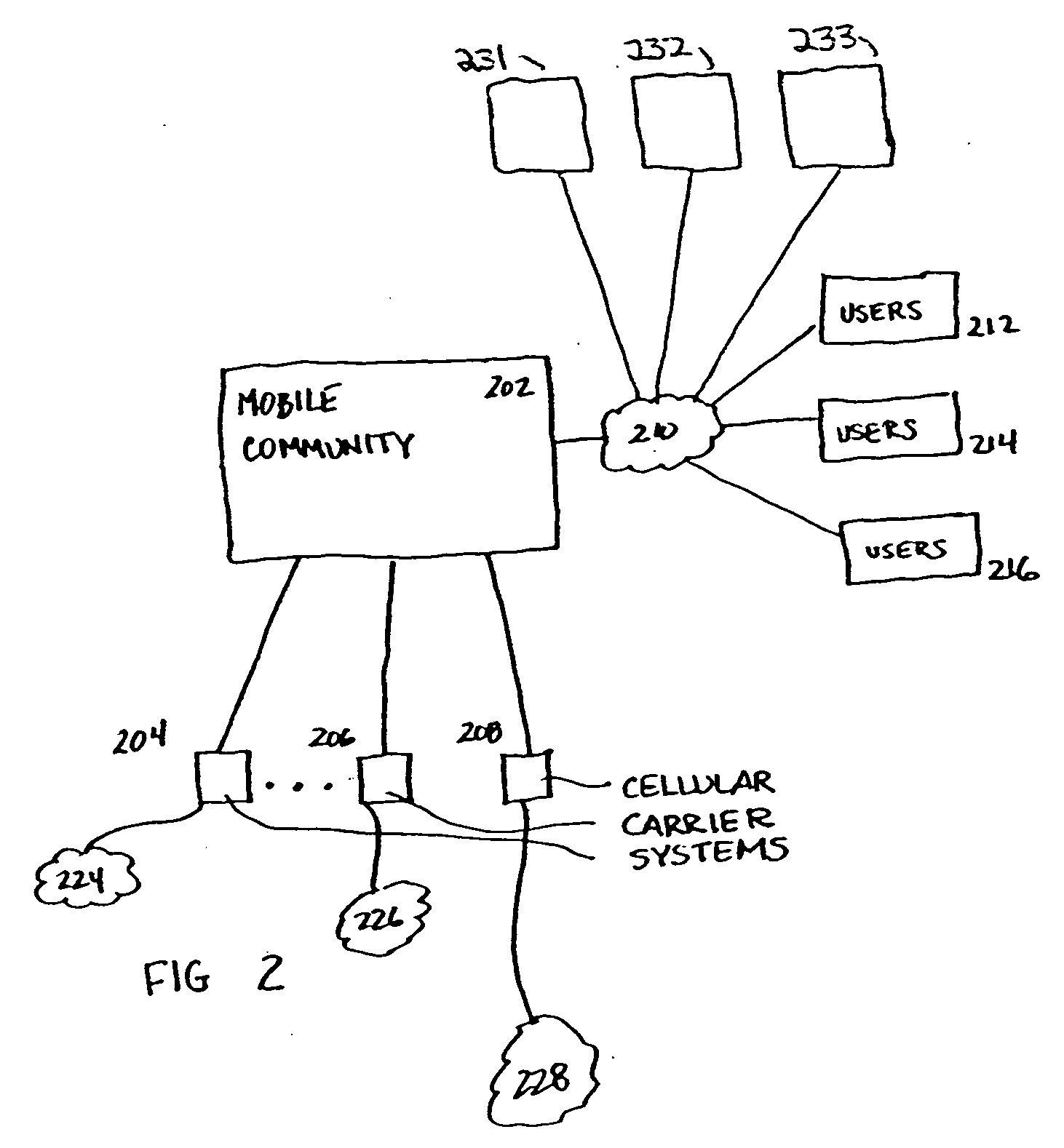

System and method for controlling financial transactions over a wireless network

InactiveUS7167711B1Hand manipulated computer devicesFrequency-division multiplex detailsCredit cardPersonal identification number

A system and method for controlling financial transactions is disclosed. A customer, using a wireless device, identifies a point of sale and the amount of a transaction at that point of sale is first communicated to a central service and then transmitted to the wireless device for display at the wireless device. The customer can either accept the transaction amount to complete the transaction or reject the amount to cancel the transaction. The customer may have to enter a password or personal identification number to verify the authorization to use the wireless financial system. The customer is billed for the transaction via credit, debit, ATM or other methods, such as the wireless carrier or an internet provider.

Owner:UNWIRED PLANET

Billing system and method for micro-transactions

ActiveUS20060276171A1Metering/charging/biilling arrangementsFinanceEvent triggeredCustomer identification

Billing a customer through an intermediary billing system for a transaction by receiving, at the intermediary billing system, a transaction request associated with a transaction amount and a customer identification code, validating, in the intermediary billing system, the transaction request by determining whether the customer identification code corresponds to a customer that is registered with the intermediary billing system, and sending, in the case that the transaction request is valid, a billing event trigger associated with the customer identification code to an external billing mechanism, the billing event trigger representing the transaction amount.

Owner:SMS AC INC

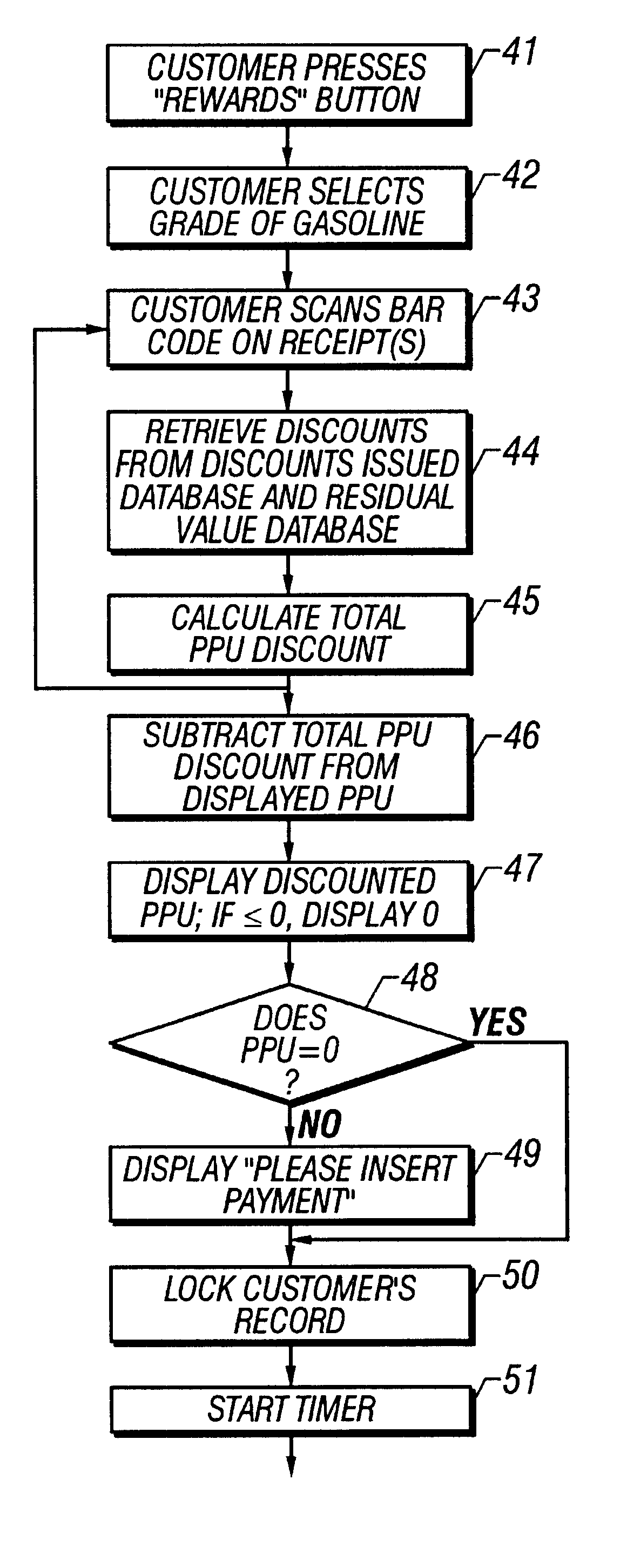

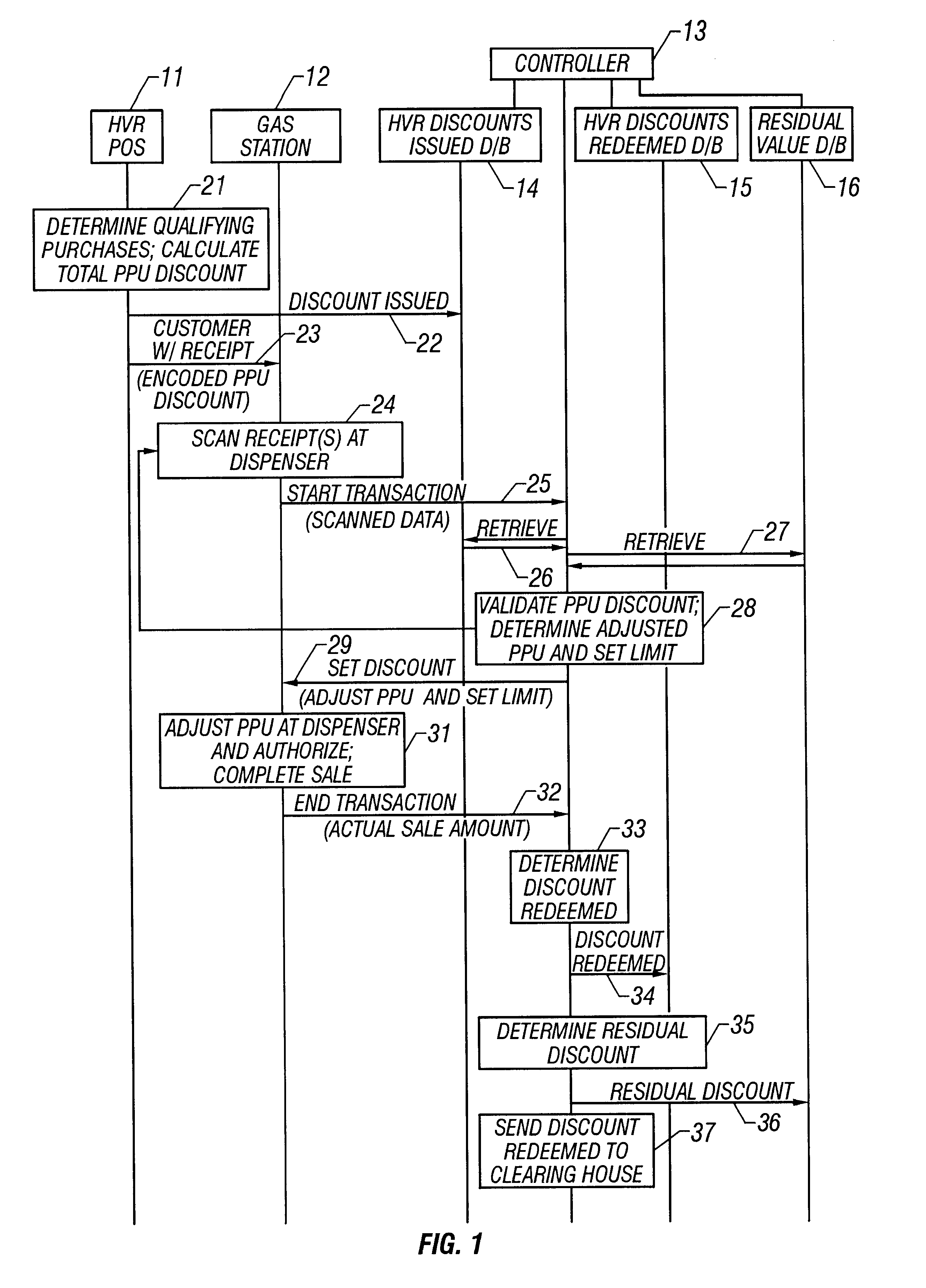

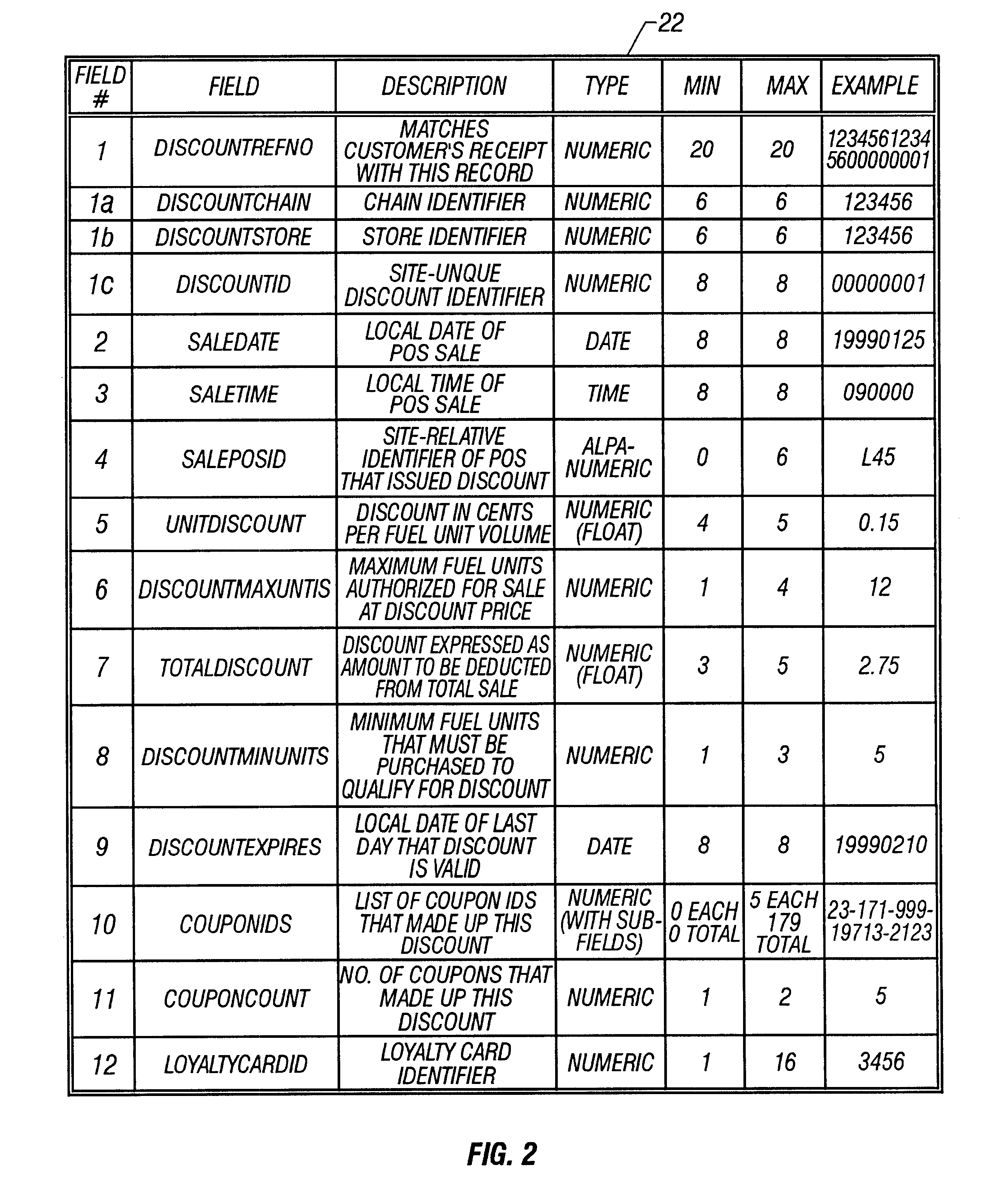

System and method of providing multiple level discounts on cross-marketed products and discounting a price-per-unit-volume of gasoline

A method of providing multiple level, price-per-unit (PPU) discounts on gasoline to a customer who purchases at least one cross-marketed product. The customer is awarded a first PPU discount on the gasoline based on a purchase by the customer of a first cross-marketed product, and is awarded a second PPU discount based on the purchase of a second cross-marketed product. The first discount is then added to the second discount to determine a total PPU discount, and a paper receipt is printed for the customer with a customer identification and a transaction identification encoded in a bar code thereon. The total discount is stored in a discounts issued database. The customer then scans the encoded bar code with a bar code scanner at a gasoline dispenser to redeem the discount. The total discount is retrieved from the discounts issued database, and the gasoline station then reduces the price-per-unit-volume of the gasoline by an amount equal to the total discount. When the customer completes the gasoline purchase, a value of the total discount redeemed is determined and stored in a discounts redeemed database. Portions of the discount redeemed are then allocated to vendors of the first and second cross-marketed products according to predetermined criteria.

Owner:EXCENTUS CORP +1

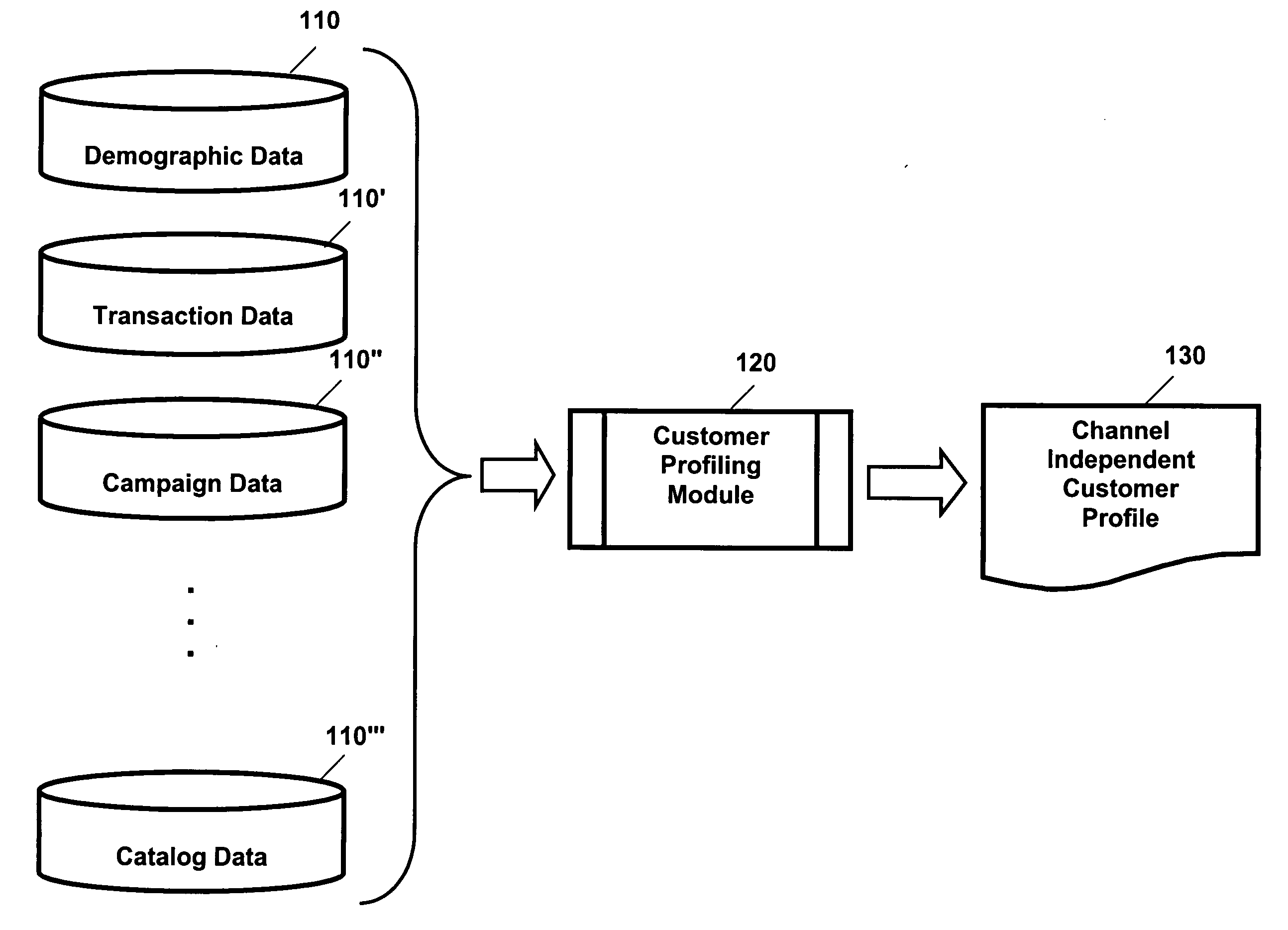

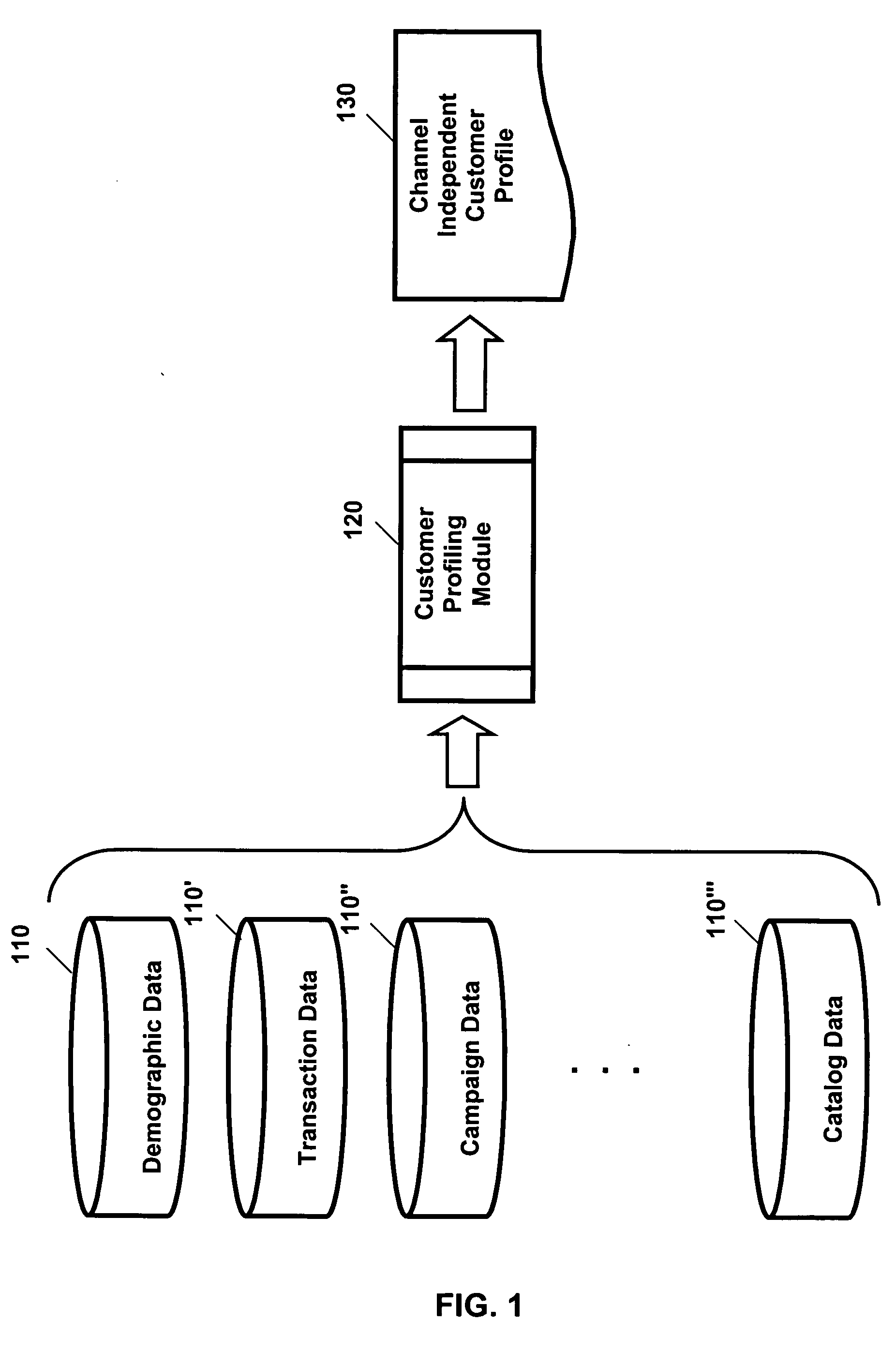

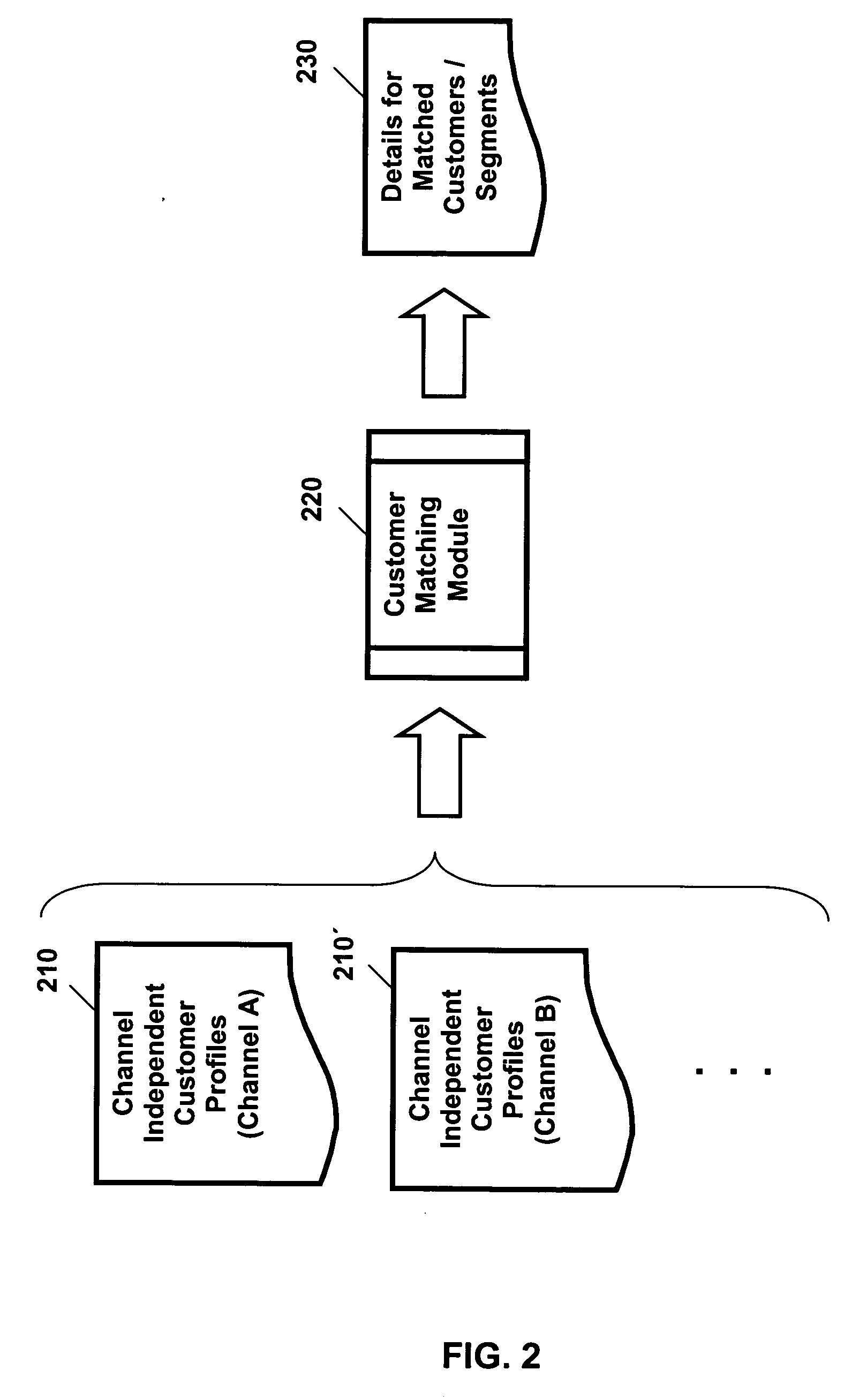

Cross-channel customer matching

A system and method for conducting cross-channel customer identification comprises accessing, for a selected customer and a selected channel, a customer profile that records values for a plurality of customer profile attributes that are independent of the selected channel; comparing the accessed customer profile with a plurality of corresponding customer profiles for one or more channels other than the selected channel; and identifying one or more compared customer profiles as a likely match for the computed customer profile.

Owner:IBM CORP

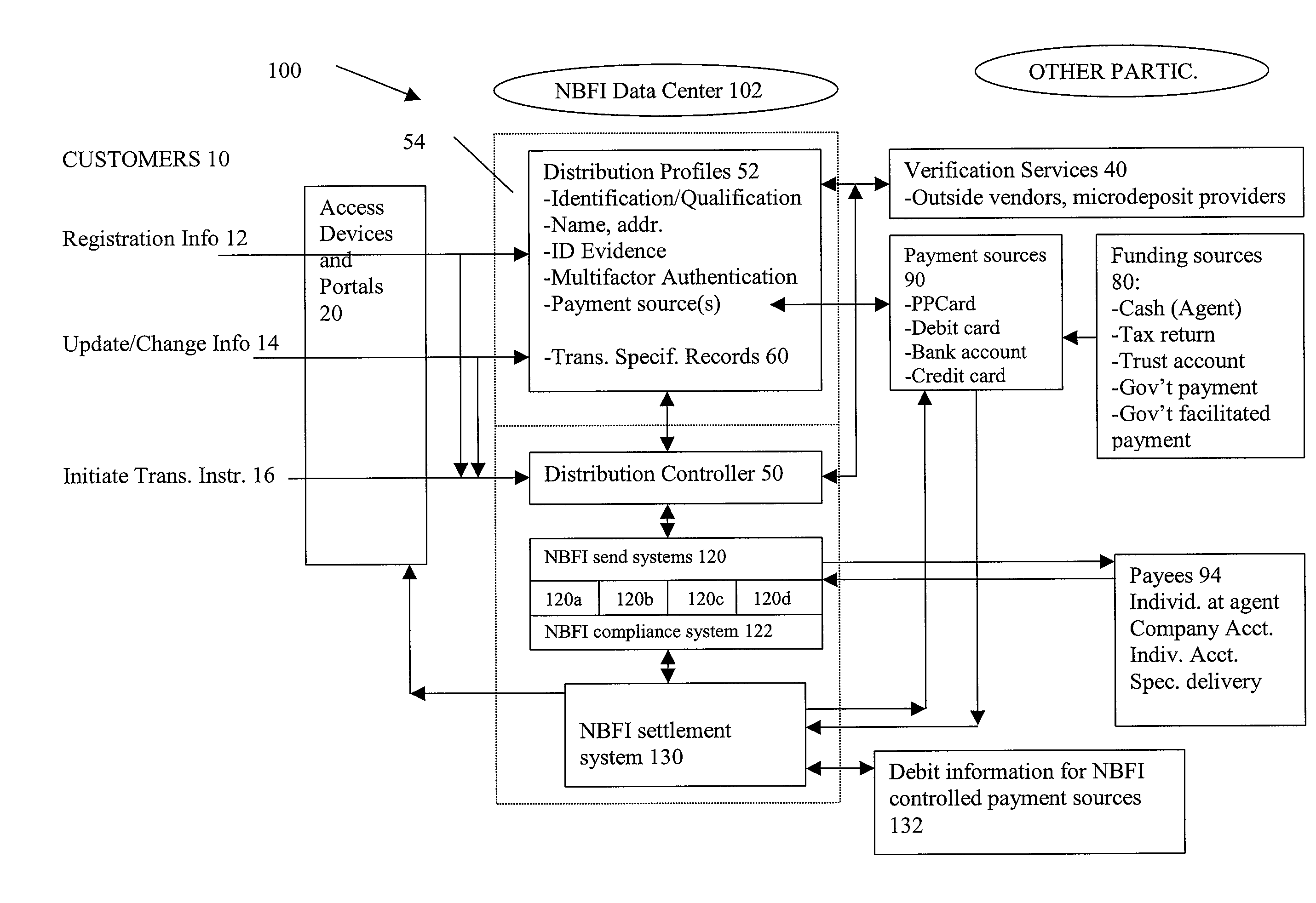

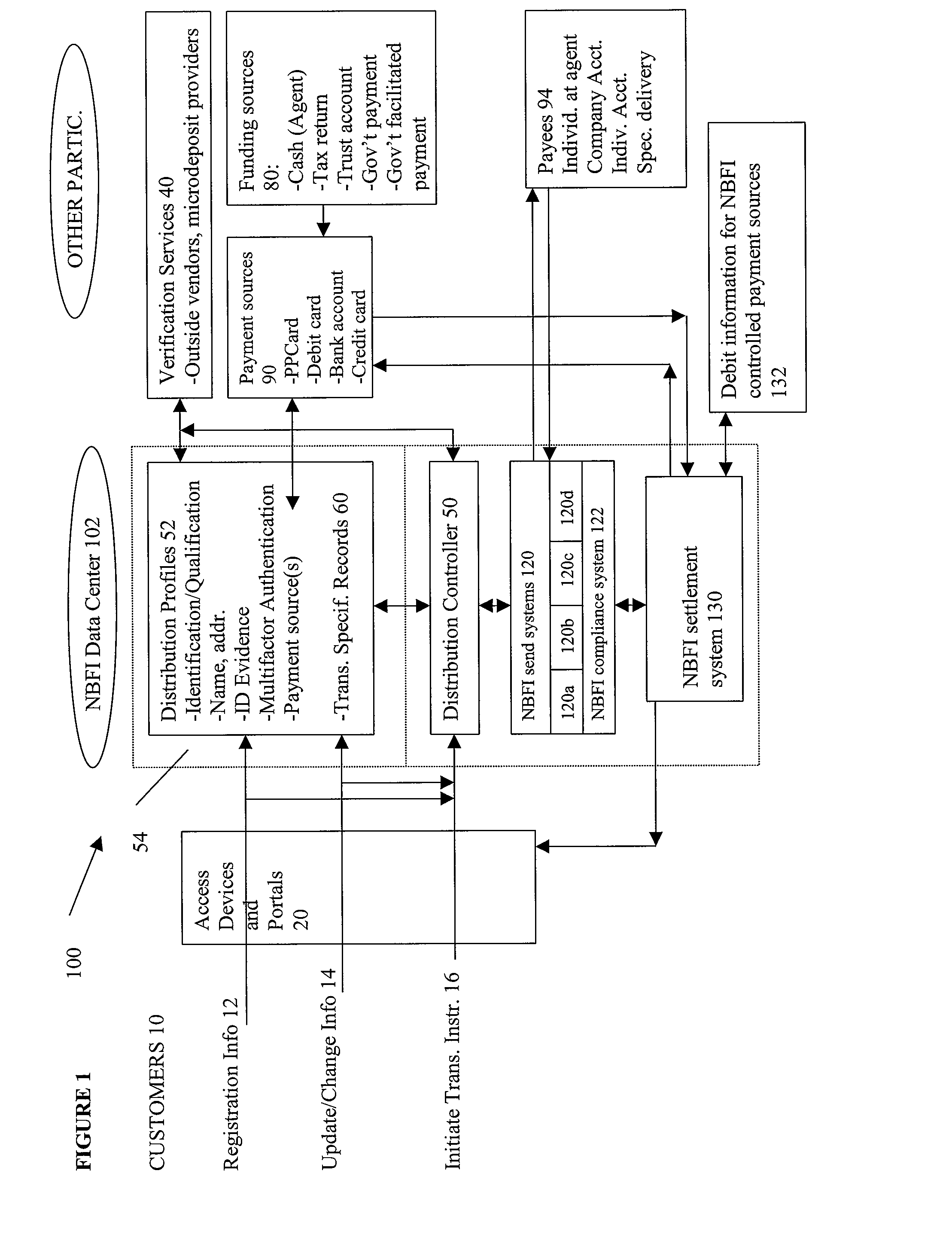

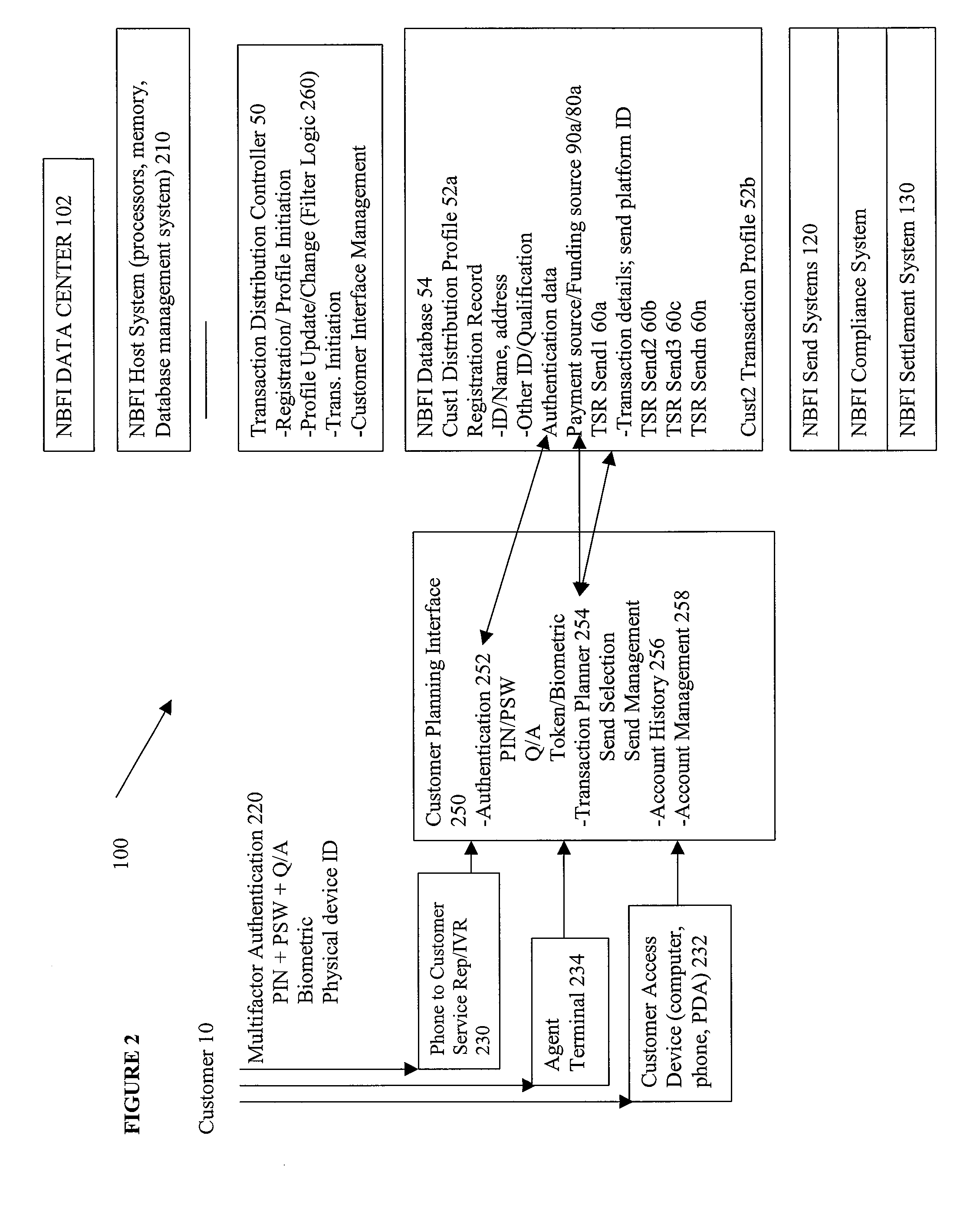

Method and apparatus for distribution of money transfers

A method of performing money transfer send transactions begins with receiving registration information from a customer, including customer identification and qualification information and payment source identification and performing verification of at least a portion of the identification and qualification information and the payment source identification and upon sufficient verification building a distribution profile. The method proceeds by receiving from the customer and storing in the distribution profile send transaction specifications for staging each of one or more proposed send transactions, and receiving a send initiation instruction with associated customer authentication data and responsive thereto identifying a distribution profile and at least one send transaction specification to be executed. Responsive to the send initiation instruction, the method verifies the authentication data and the current status of the payment source identified in the distribution profile and upon sufficient verification, initiates a send transaction according to the at least one send transaction specification.

Owner:MONEYGRAM INT

System, method, and computer program product for selecting and presenting financial products and services

A method and apparatus are provided for automatically preparing a client communication pertaining to a financial product for a client, wherein the client communication is for combined use with a corresponding host vehicle. The method comprises providing a format for the client communication wherein the communication format includes a variable portion; inputting into a computer-accessible storage medium variable information other than a client identification; inputting into the storage medium decision information; and using the decision information to select a subset of the variable information for inclusion in a variable portion of the client communication corresponding to the variable portion of the client communication format. The apparatus comprises an inputting device for inputting into a computer-accessible storage medium variable information comprising other than a client identification and decision information; a processor operatively coupled to the storage medium for using the decision information to automatically select a subset of the variable information for each of the clients; and an output preparing component in operative communication with the processor for preparing the client communications and for automatically inserting into the client communication the subset of variable information for the corresponding and respective client.

Owner:PHOENIX LICENSING

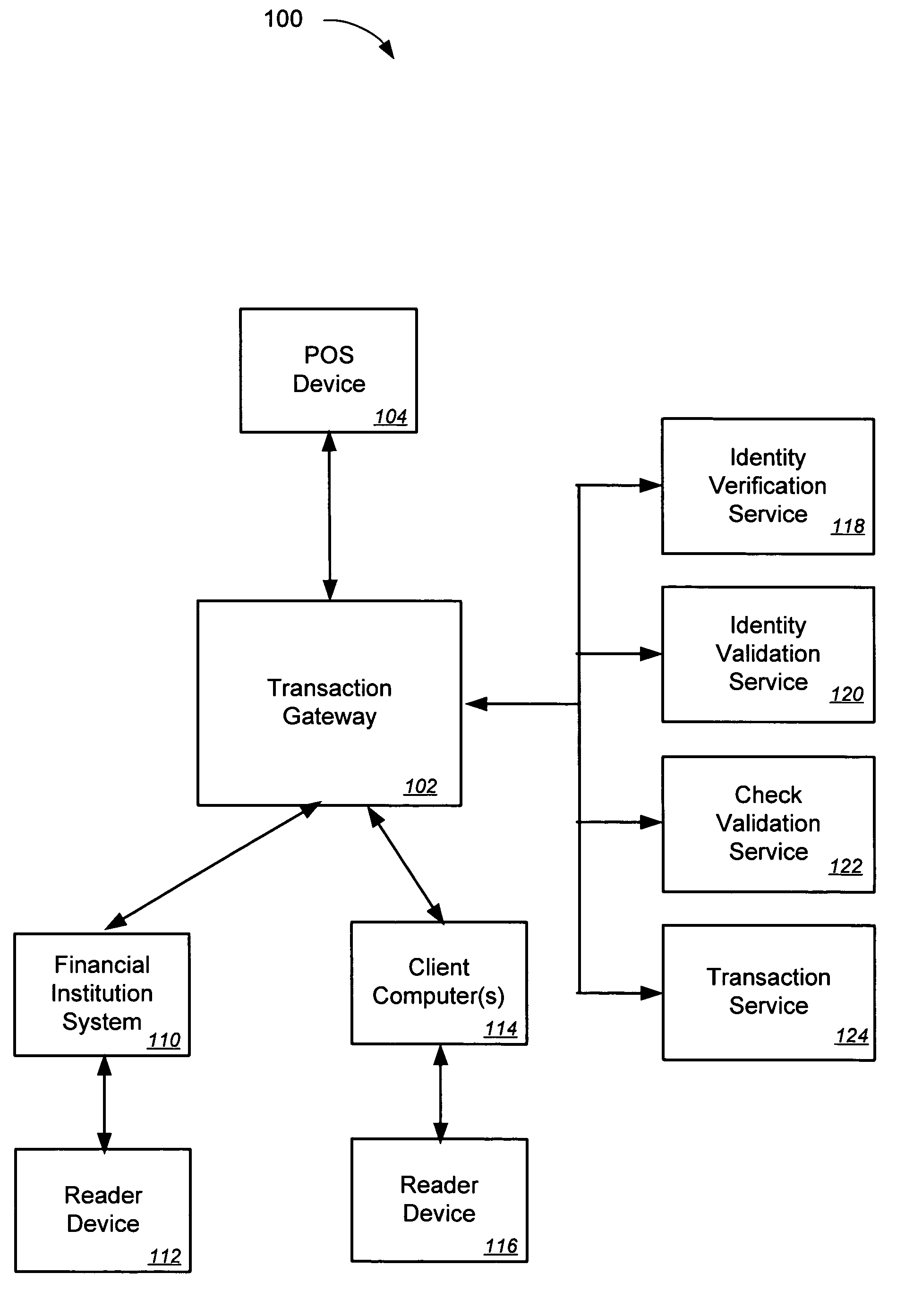

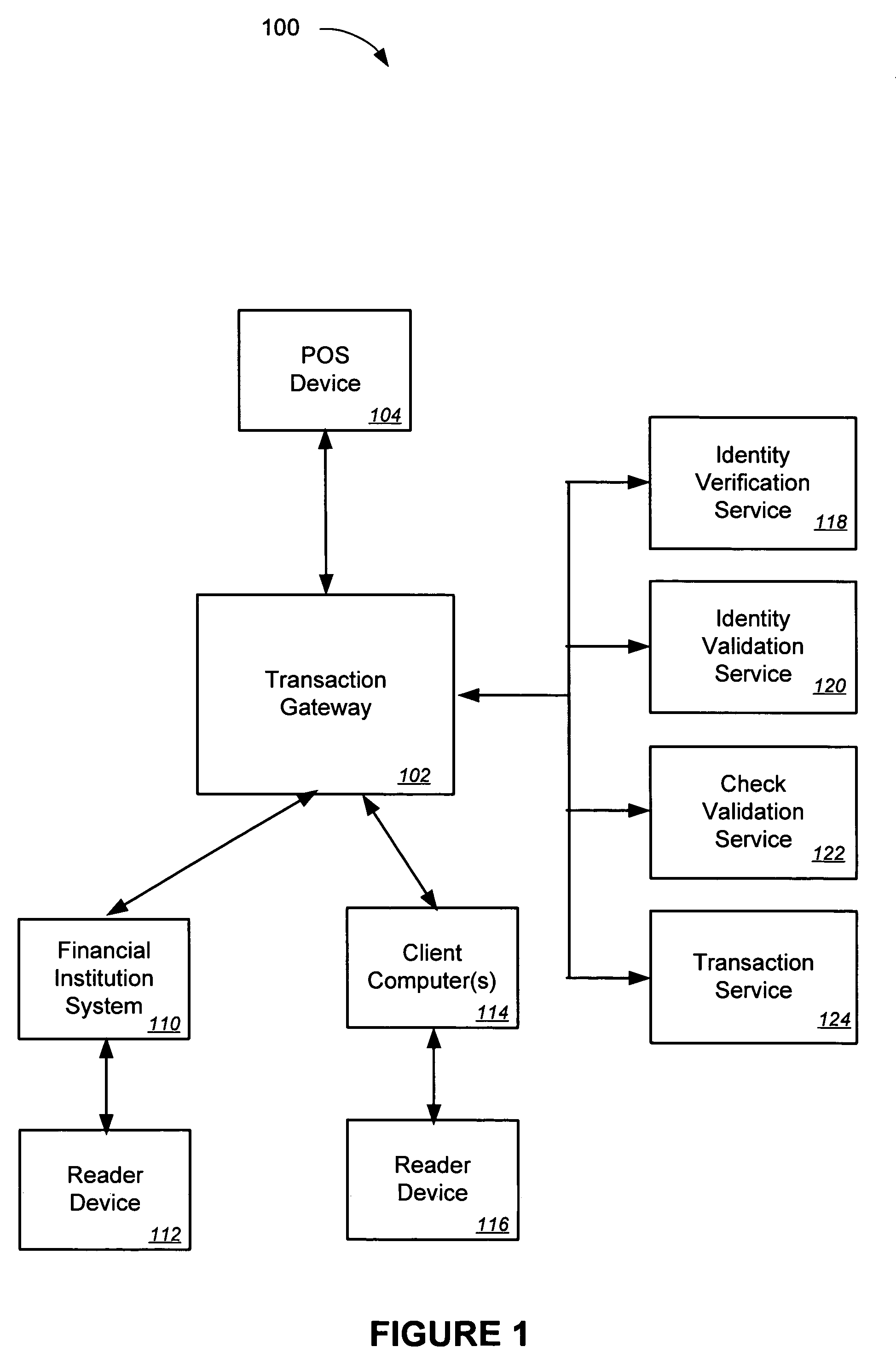

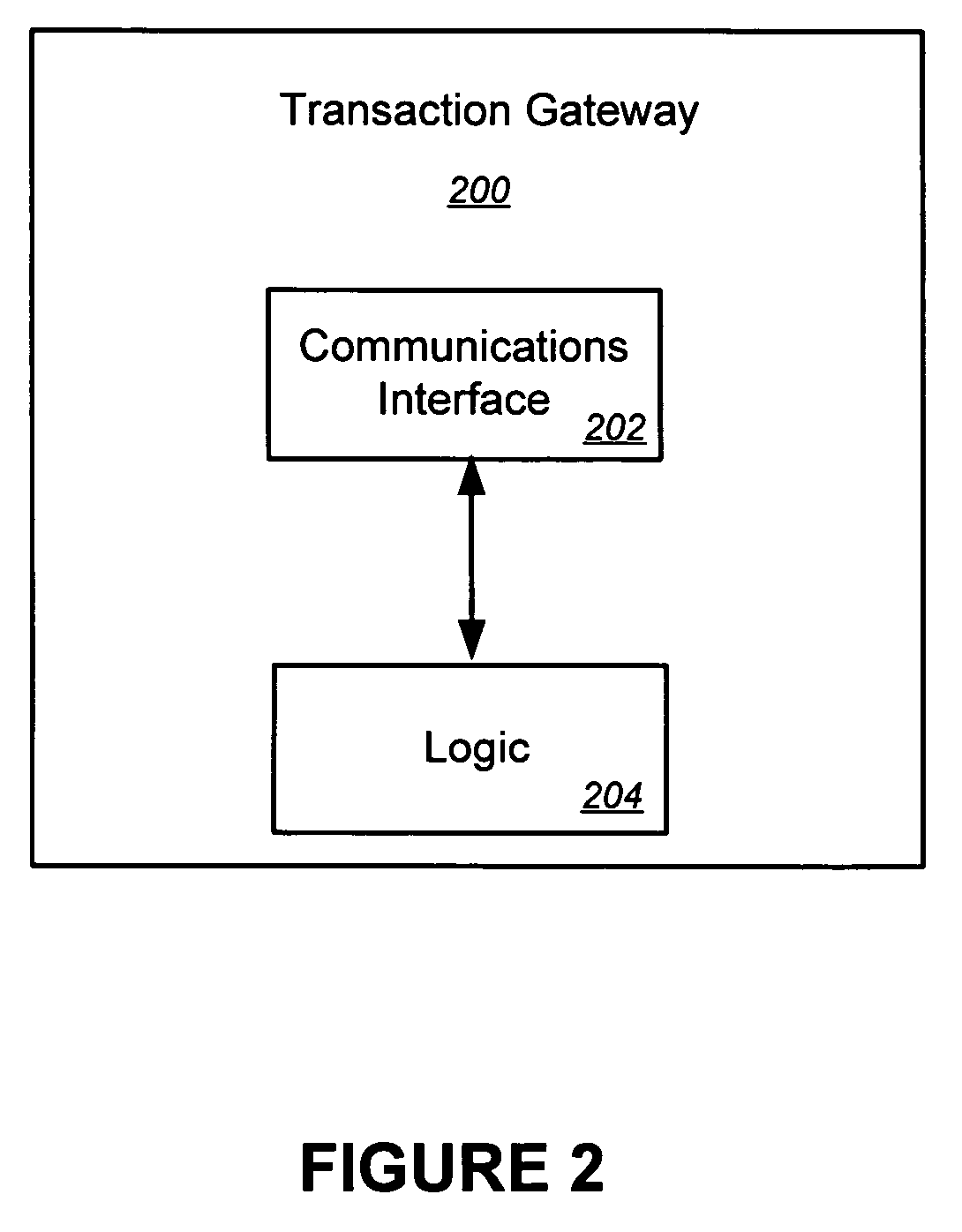

Identity verification systems and methods

Systems and methods are disclosed for verifying customer identifications. In one embodiment, the method comprises receiving, at a transaction gateway, a communication associated with a transaction initiated by a customer; determining the communication includes an identity verification request to verify encoded data obtained from an identification presented by the customer; routing the identity verification request to an identity verification service; receiving, from the identity verification service, a result including one or more identification values obtained from the encoded data; and transmitting the result to a requester associated with the communication.

Owner:EARLY WARNING SERVICES

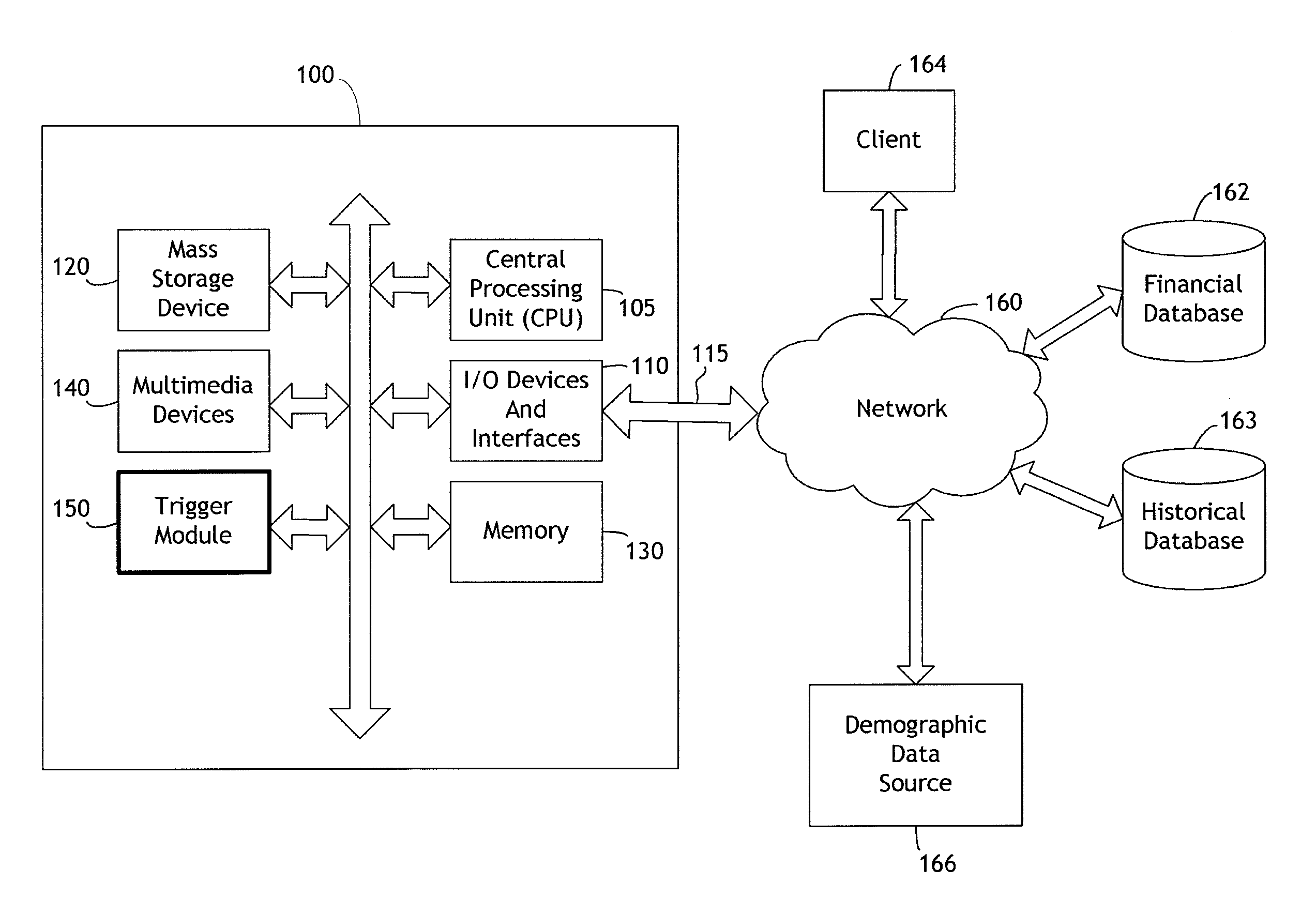

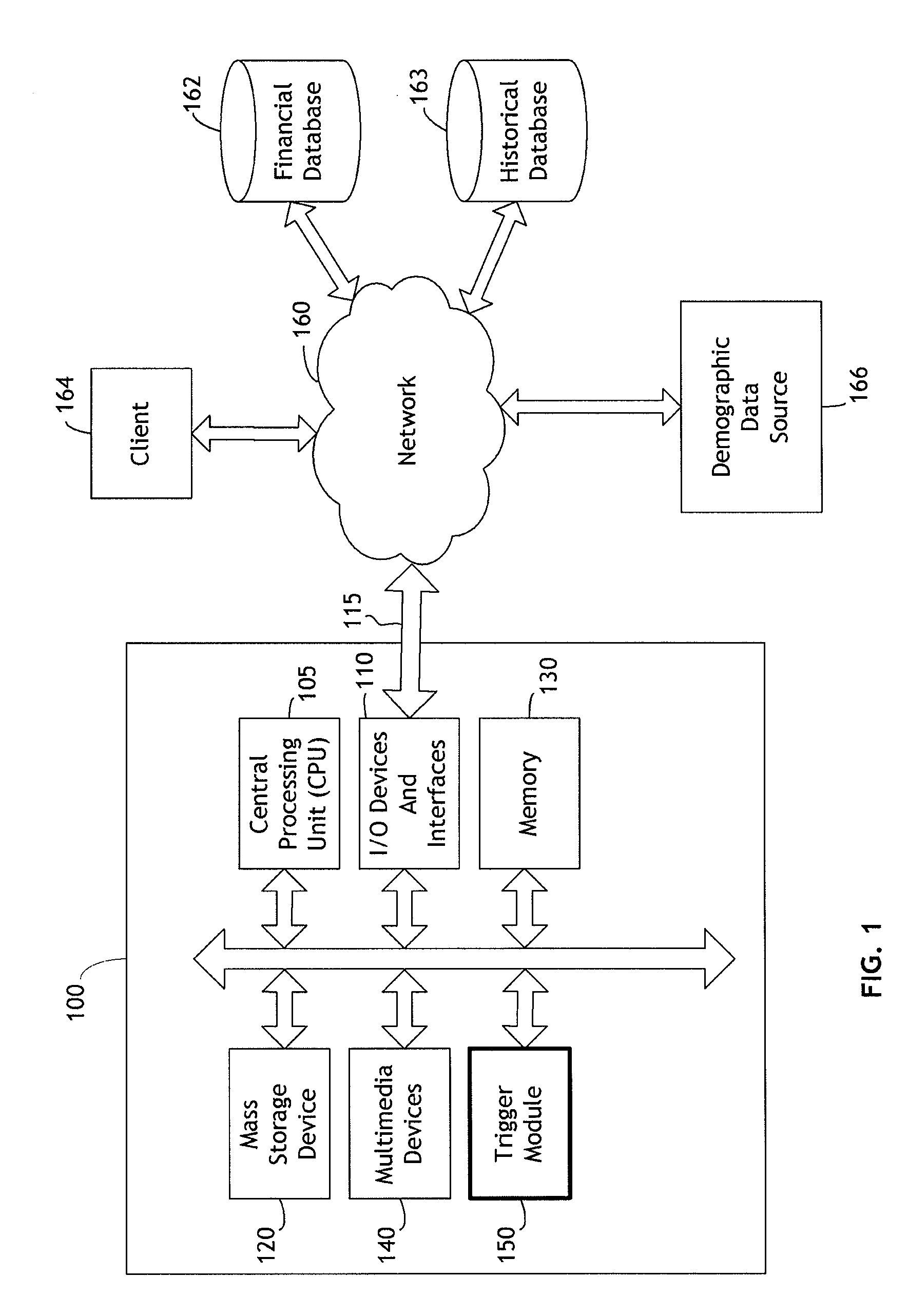

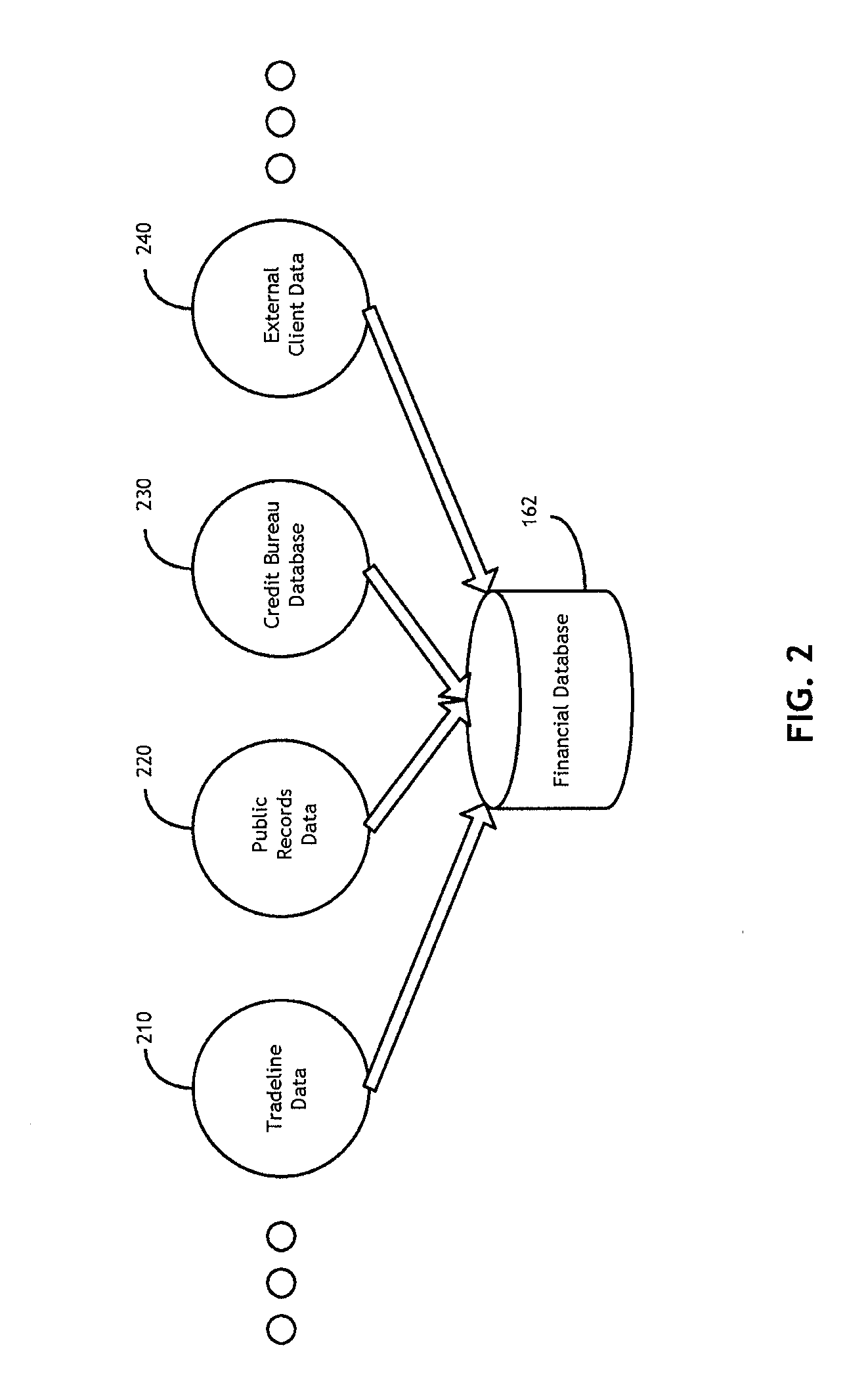

Systems and methods for monitoring financial activities of consumers

Systems and methods are disclosed for monitoring consumer financial data. Clients such as financial institutions or debt buyers identify one or more consumers for which monitoring is desired. Historical financial data, such as credit data, is periodically compared with current financial data according to a number of logical rules or financial triggers. The financial triggers correspond to improvements in a financial position of a consumer. When a financial improvement is determined according to the logical rules, an alert is generated and sent to the client, allowing the client to adjust a collection strategy.

Owner:EXPERIAN INFORMATION SOLUTIONS +1

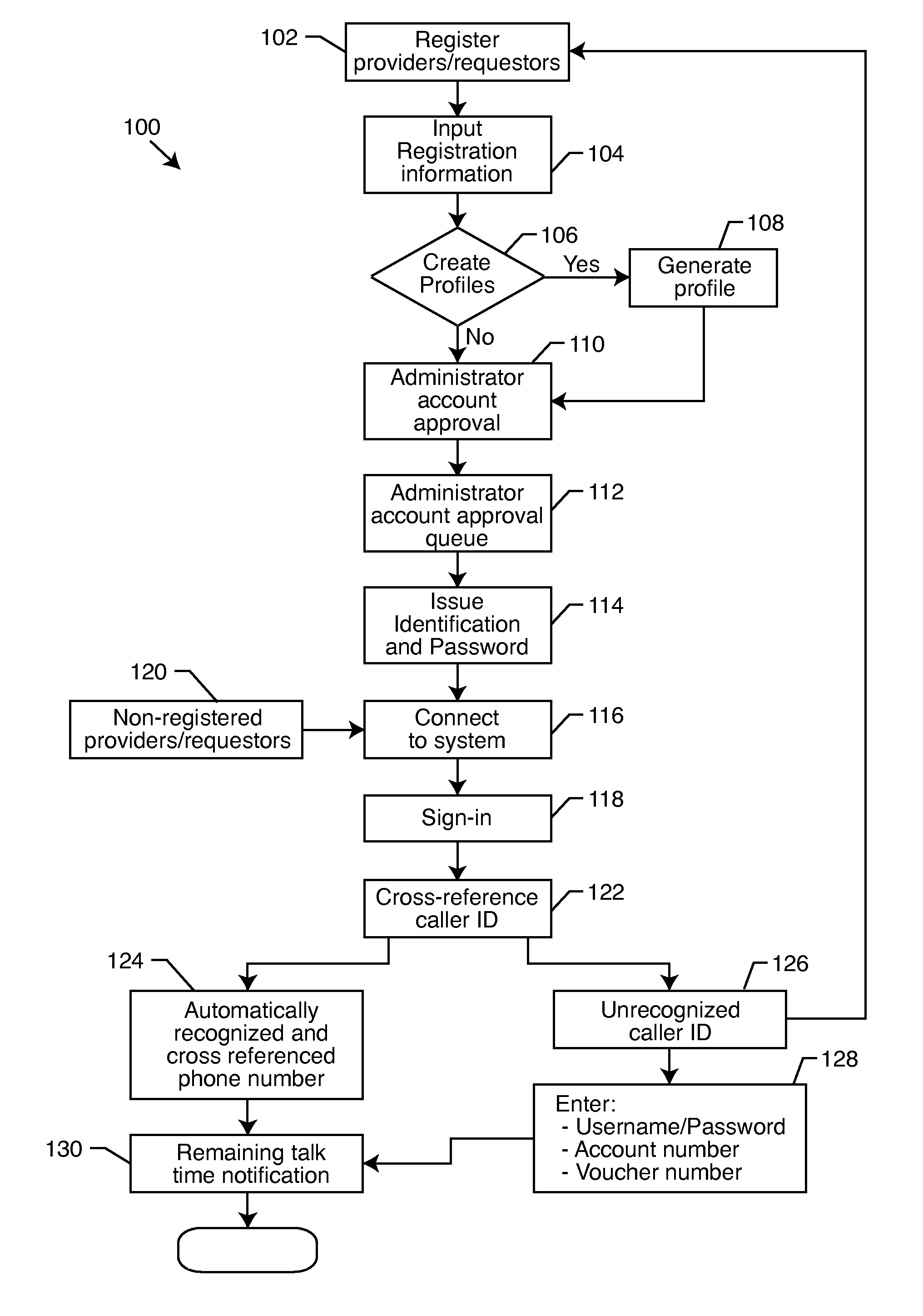

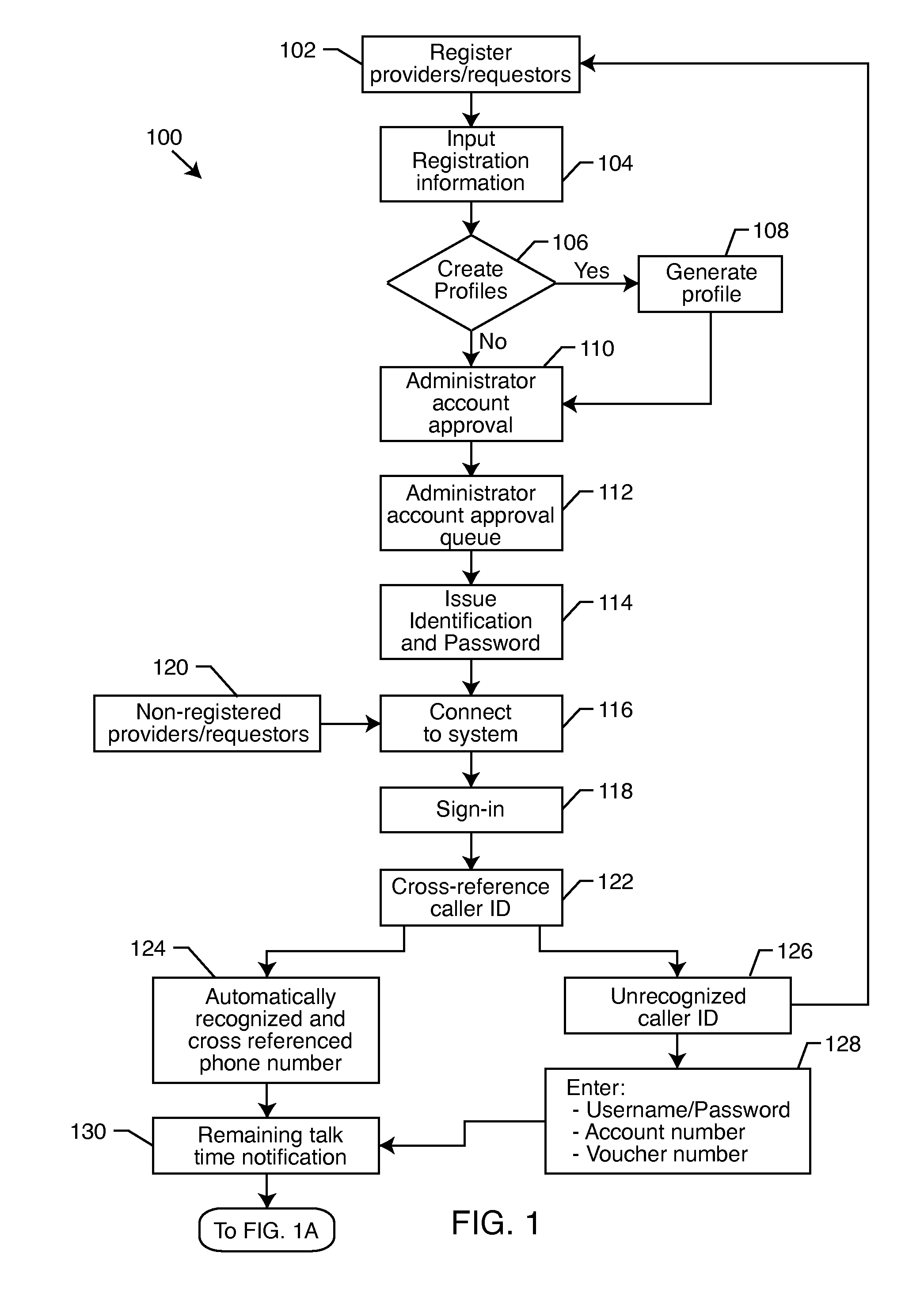

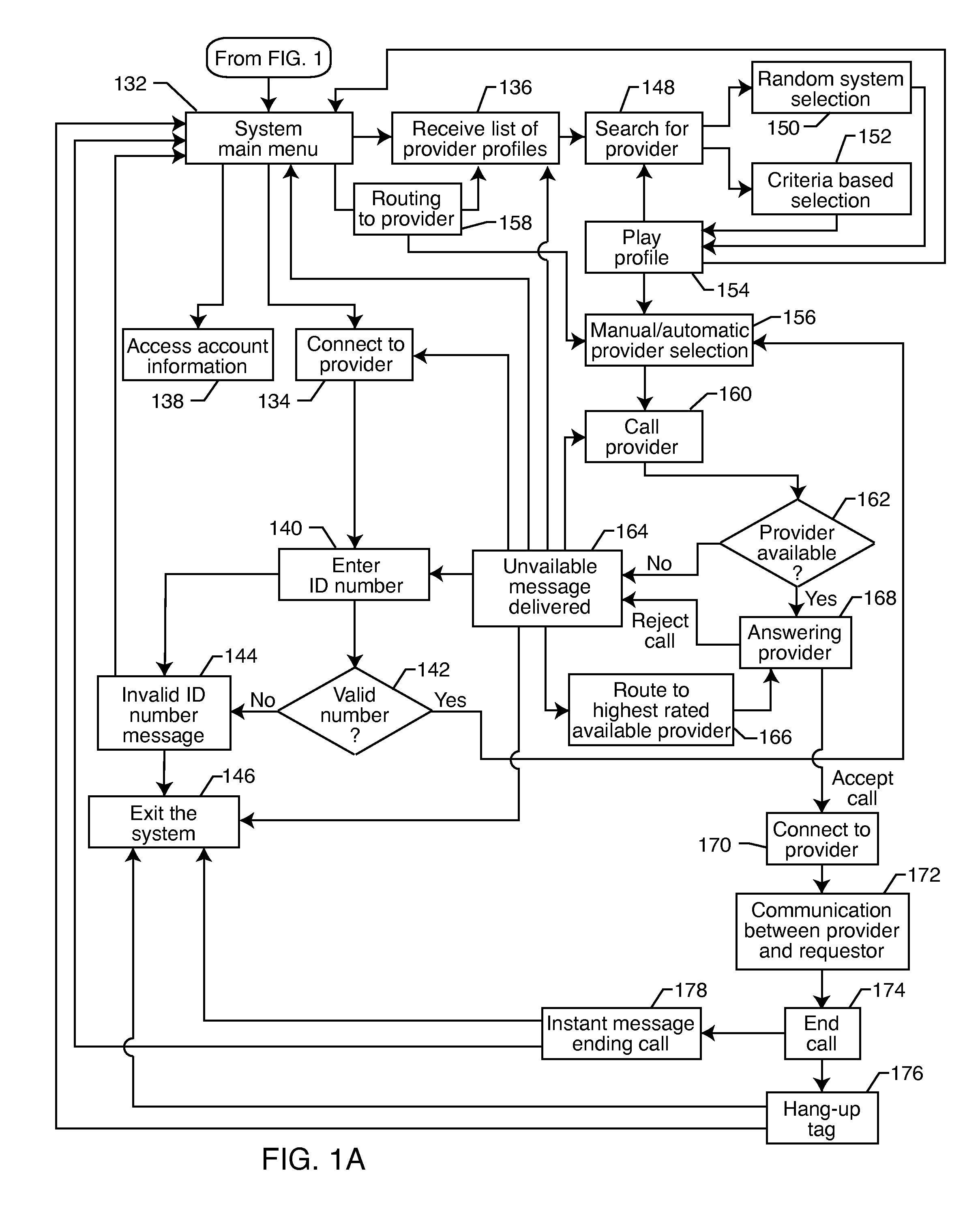

Process for obtaining expert advice on-demand

Obtaining expert advice on-demand includes maintaining a substantially real-time list of available experts in selected fields, in an electronic database. The system receives a request from a customer for expert advice in one or more of the selected fields maintained in the electronic database. The system then electronically identifies one or more available experts to the customer in response to the request received and routes the request for expert advice to at least one of the available experts.

Owner:ALLSCRIPTS SOFTWARE +1

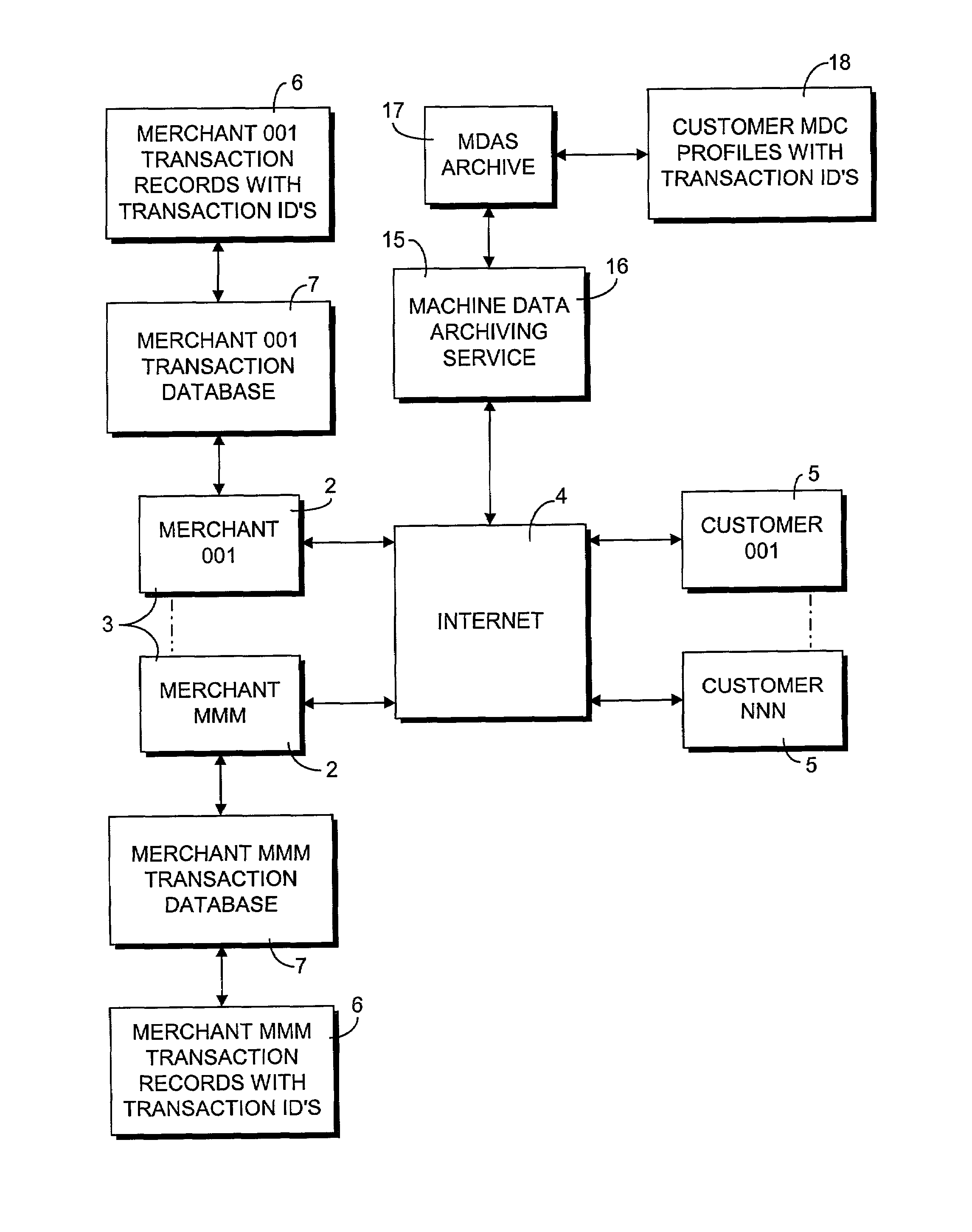

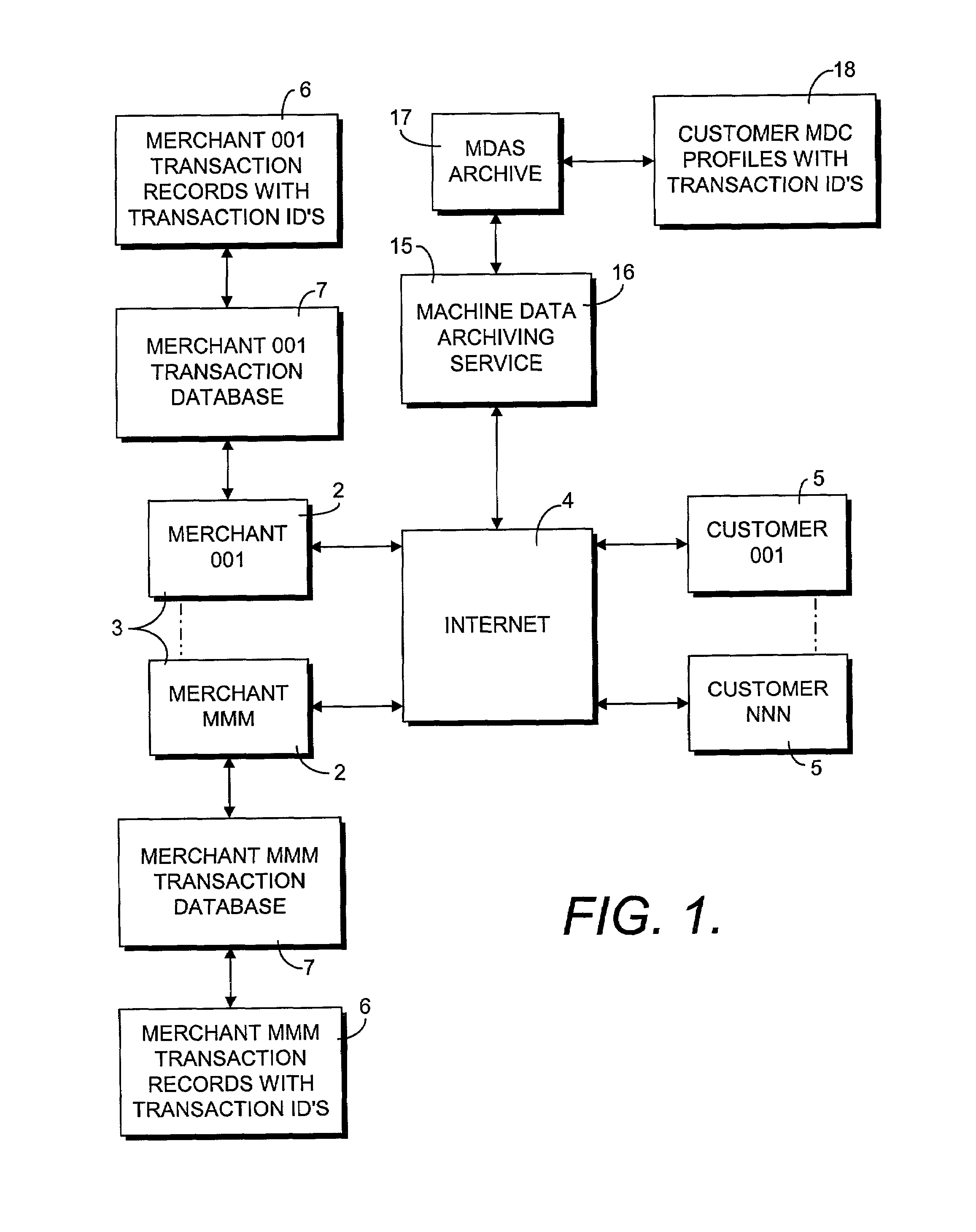

Online machine data collection and archiving process

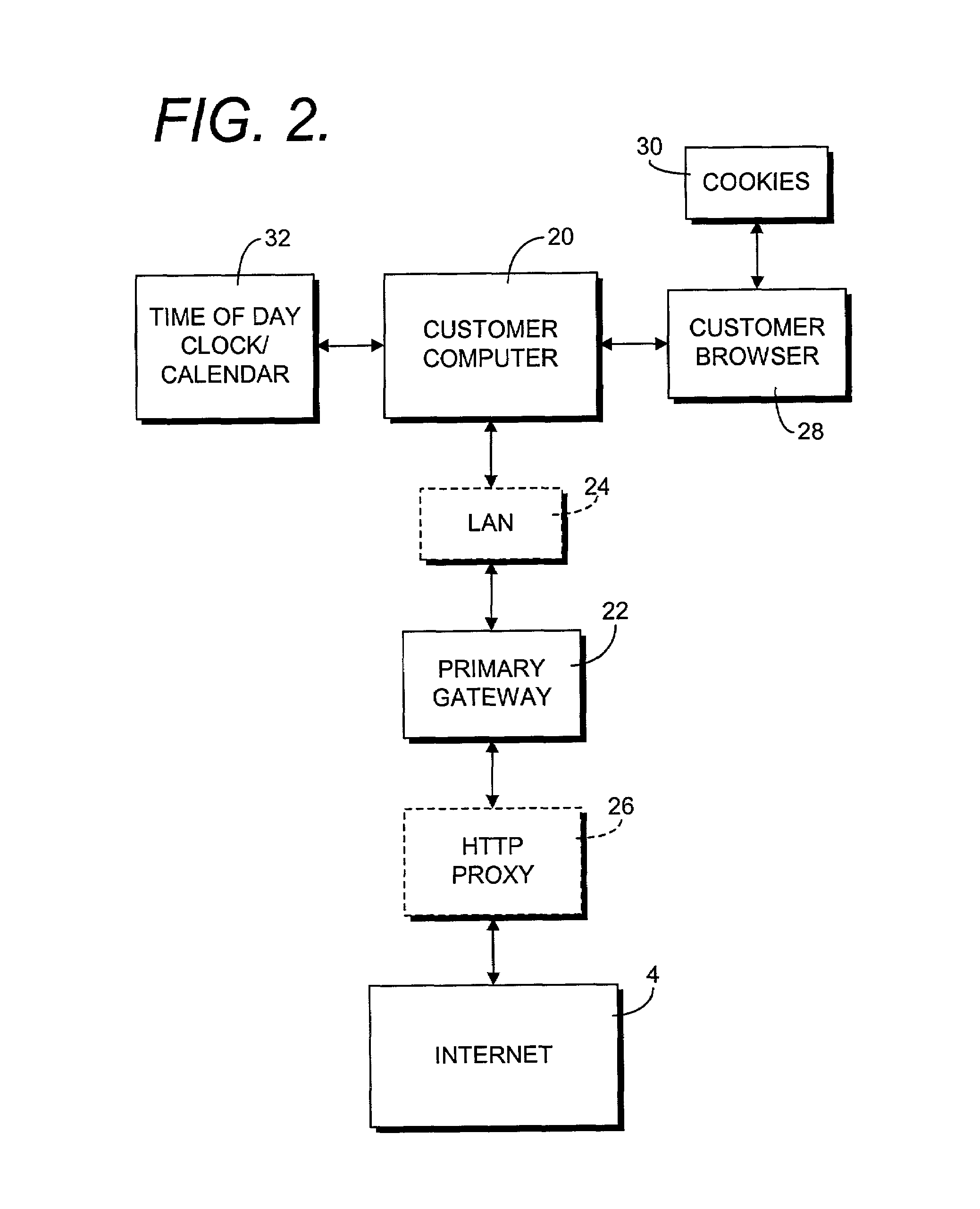

InactiveUS7330871B2Narrow machine profileFinanceMultiple digital computer combinationsWeb siteIp address

An online machine data collection and archiving process generates a machine data profile of a customer computer accessing a transaction form of a merchant web site and links the machine data profile and a transaction record with customer identifying information using a unique transaction identification string. The process preferably captures parameters typically communicated as a part of web accesses, such as an IP address, an HTTP header, and cookie information. The process additionally causes the customer computer to process self-identification routines by processing coding within the merchant transaction form, the self-identification routines yielding further profile parameters. The process further includes a routine for bypassing an intervening proxy to the merchant web site to reveal the true IP address of the customer computer.

Owner:KOUNT

Payment transaction client, server and system

InactiveUS20120150737A1Eliminate needLow implementation costFinancePoint-of-sale network systemsPayment transactionBarcode

The invention relates to a system for handling payment transactions, comprising a payment transaction client and a payment transaction server. A customer identifies himself by providing a code to a shop, preferably by a bar code. The shop sends customer identification, shop identification, client identification and the amount to the server. The server looks up further customer information, checks the balance on the account of customer and issues a payment confirmation code to the mobile telephone of the customer if the customer has enough credit on the account. The customer provides the code to the shop or directly to the client, upon which the client sends the payment confirmation code and further information like the information sent previously to the server. If the confirmation code received matches the confirmation code issues early, the server executes the payment or instructs a bank to execute the payment.

Owner:EURO WALLET

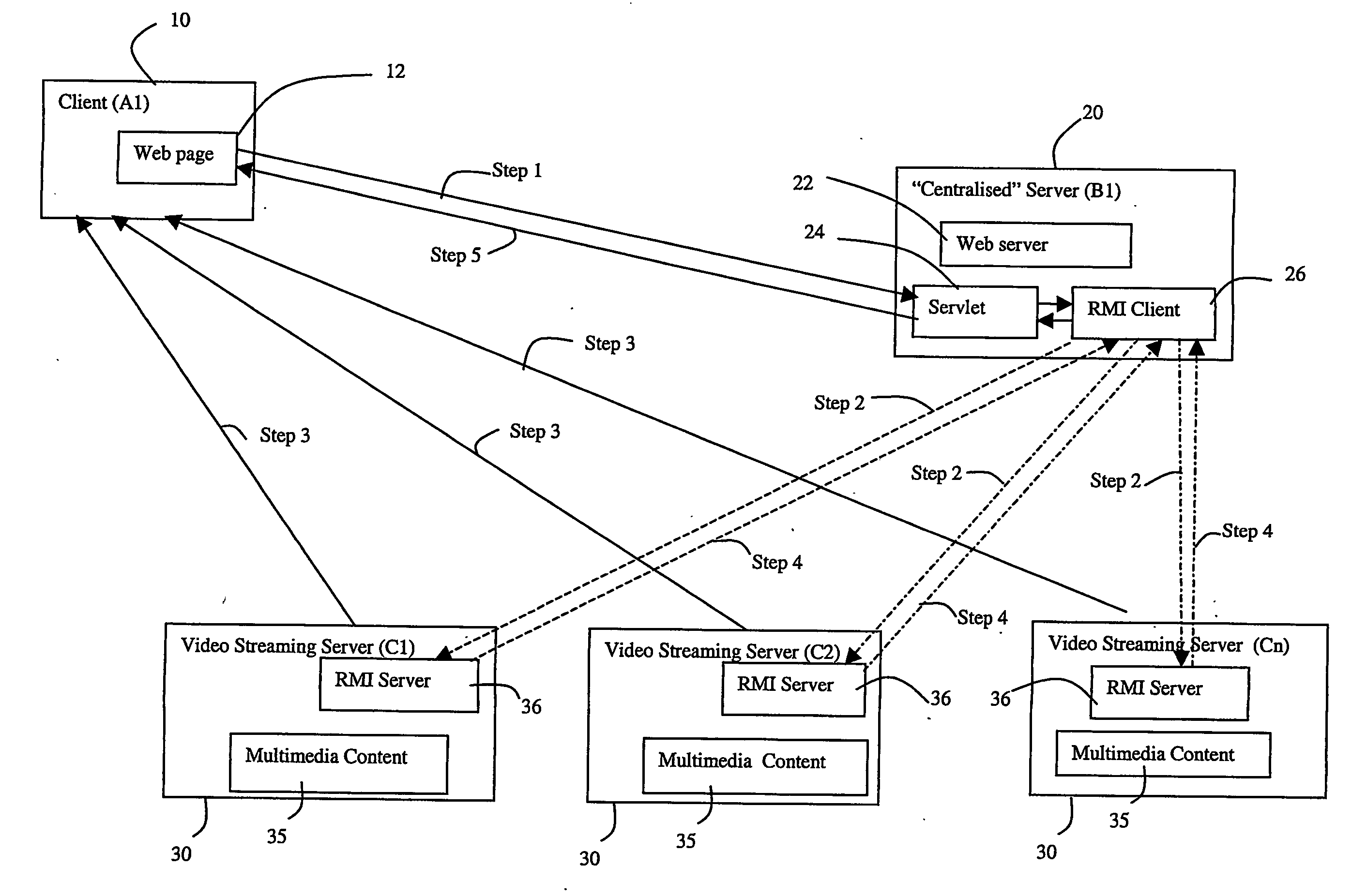

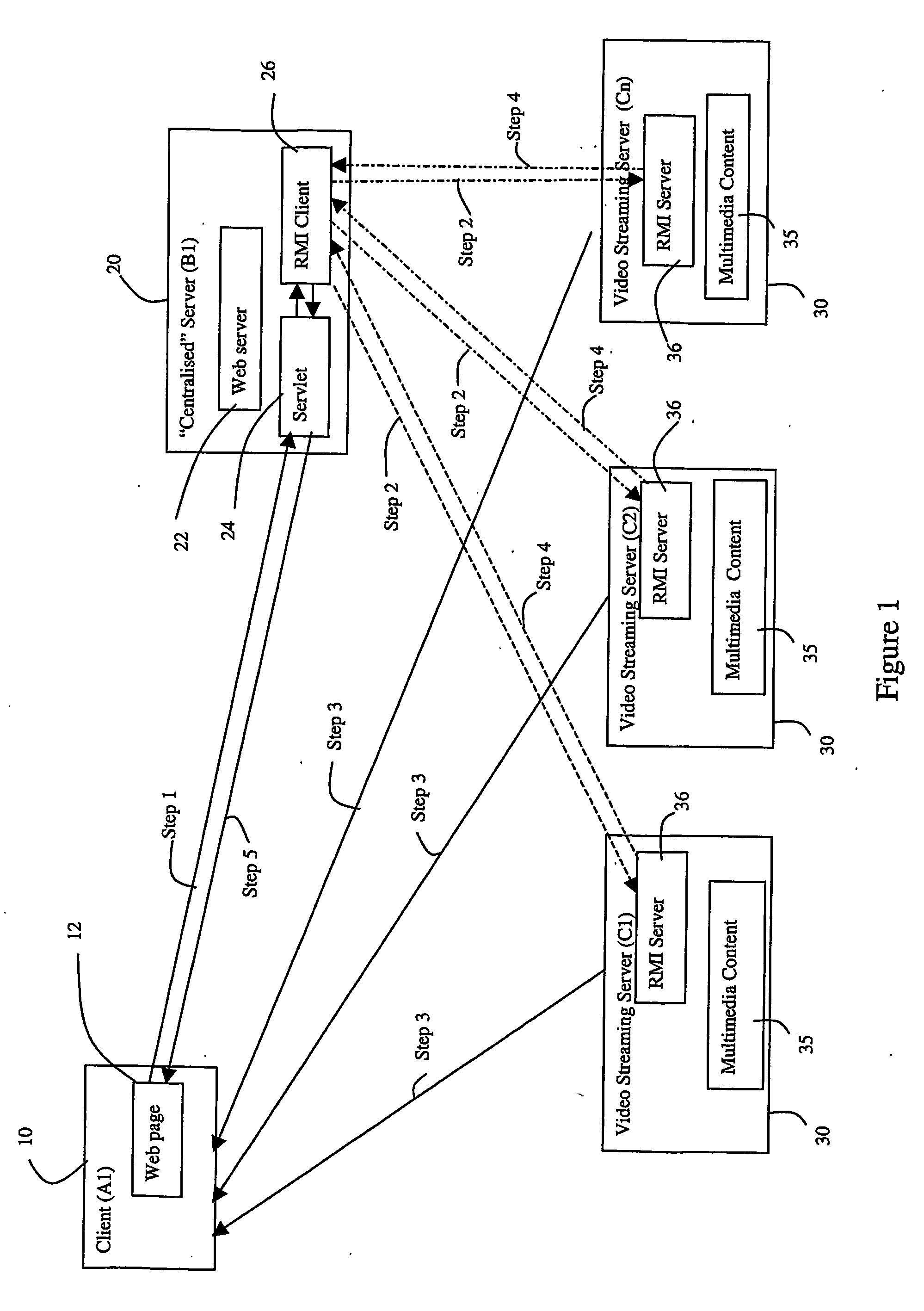

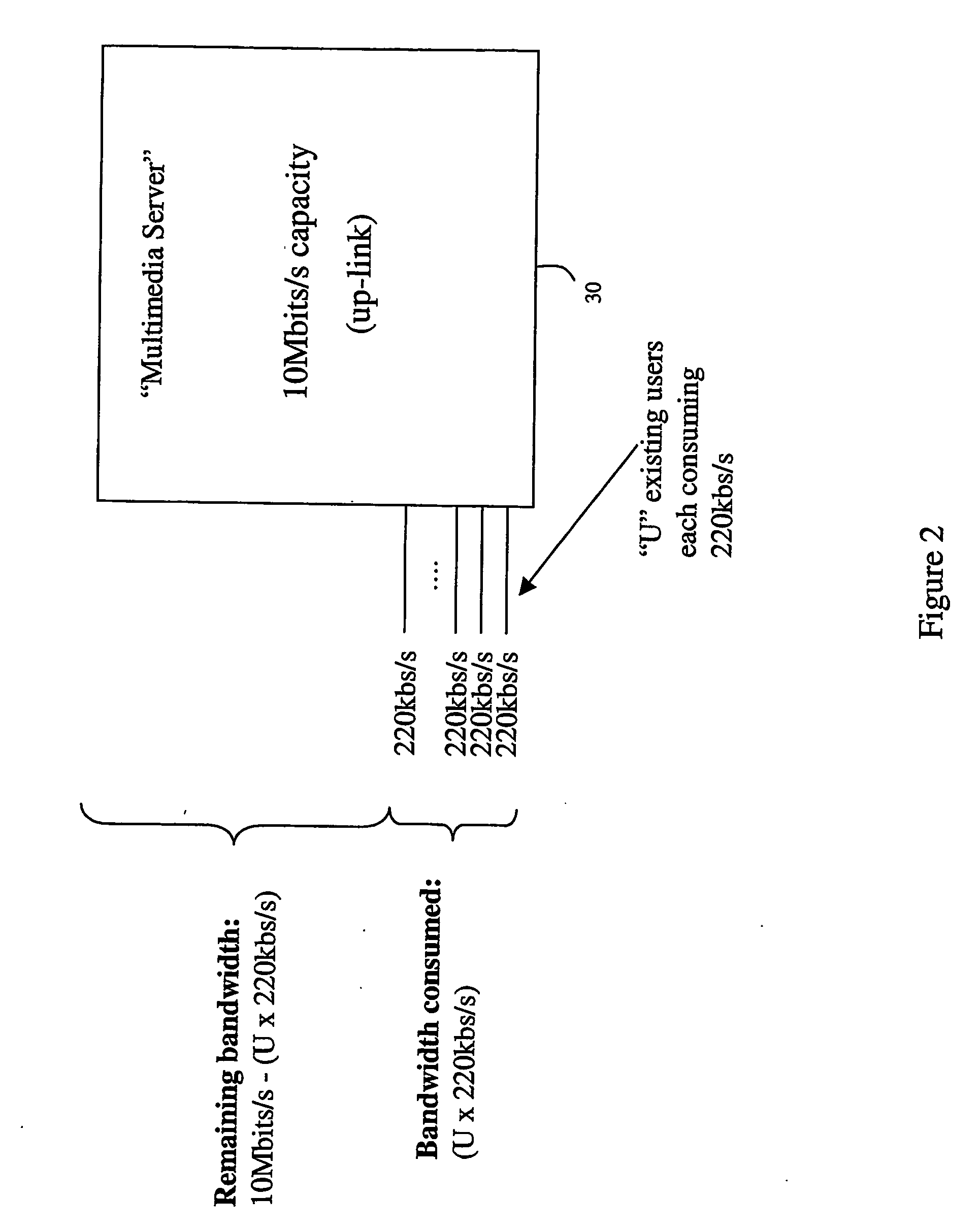

System and method for selecting data providers

ActiveUS20060245367A1Improve experienceError preventionFrequency-division multiplex detailsData providerClient-side

A system (20) and method by virtue of which a preferred data provider is selected from a plurality of data providers (30) by performing the steps of receiving a request for data from a client (10) together with client identification data, identifying a plurality of data providers (30) capable of providing data to the client (10), providing the client identification data to the data providers and instructing the data providers to perform tests in order to establish a measure of the elapsed time for a signal to be sent to and received from the client, and a measure indicative of their remaining capacity for data transfer, and to make these measures available to the system (20). One or more preferred data providers (30) may then be selected on the basis of the elapsed time signals and the remaining capacity signals from said data providers.

Owner:BRITISH TELECOMM PLC

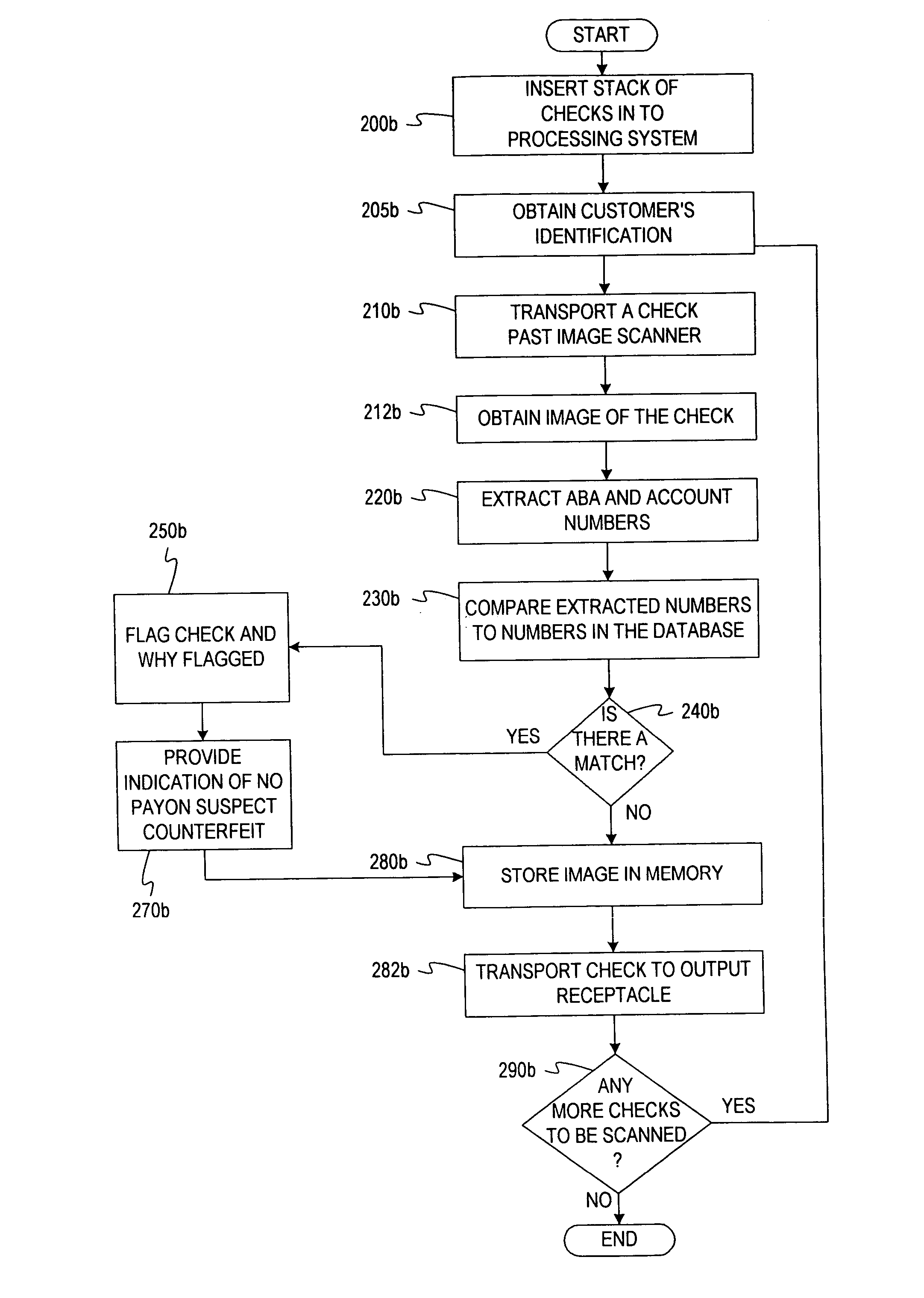

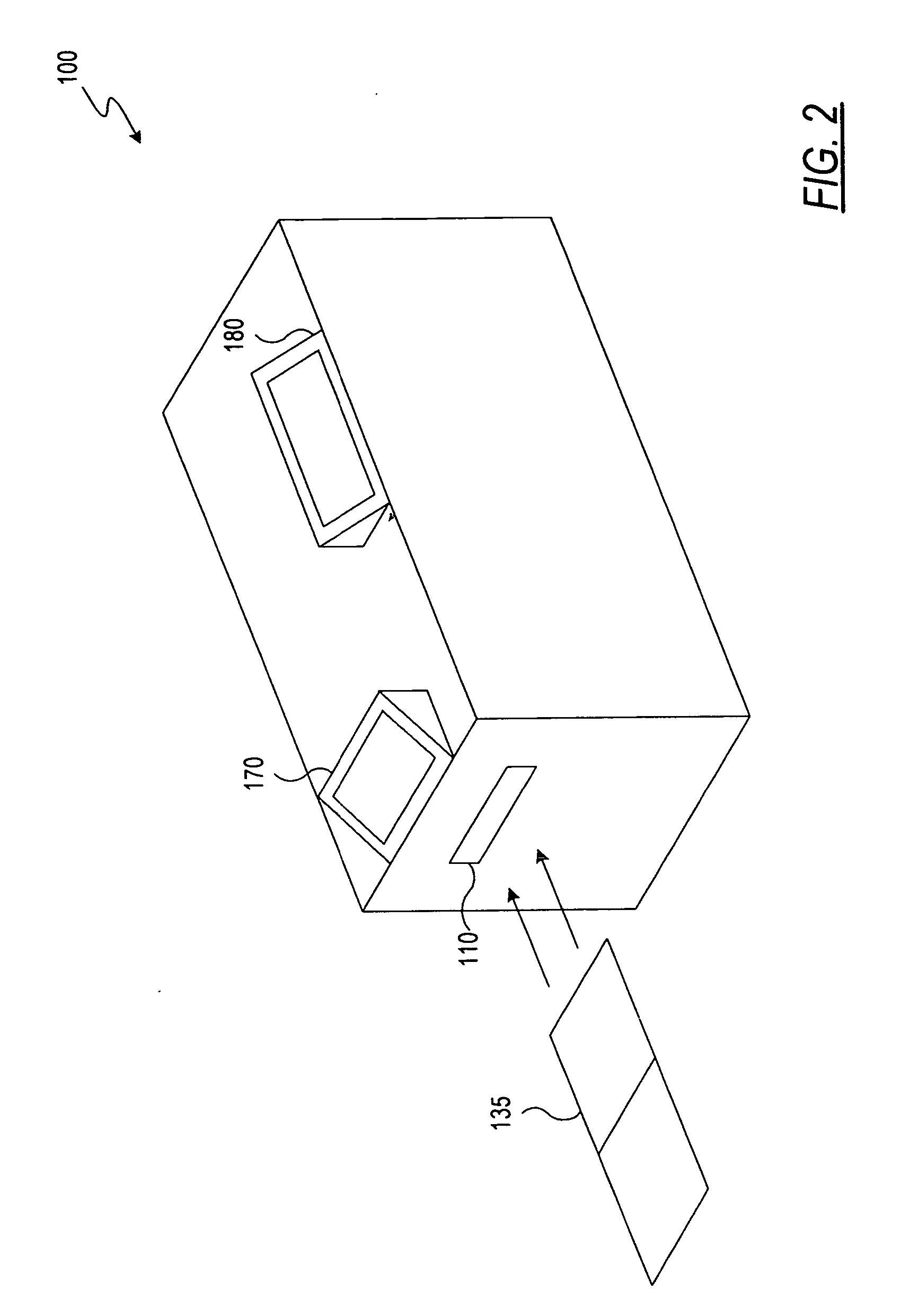

Document processing system using full image scanning

Owner:CUMMINS-ALLISON CORP

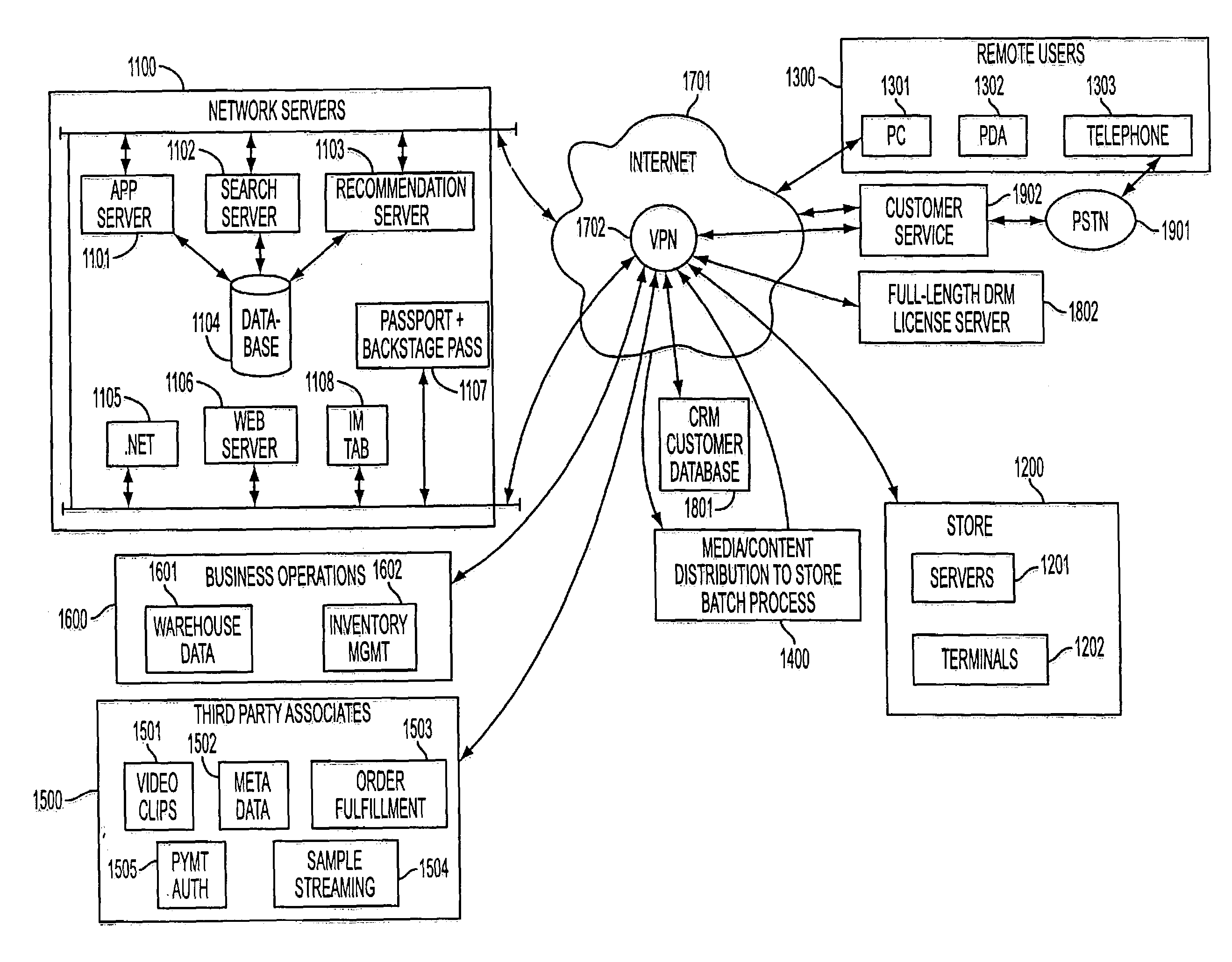

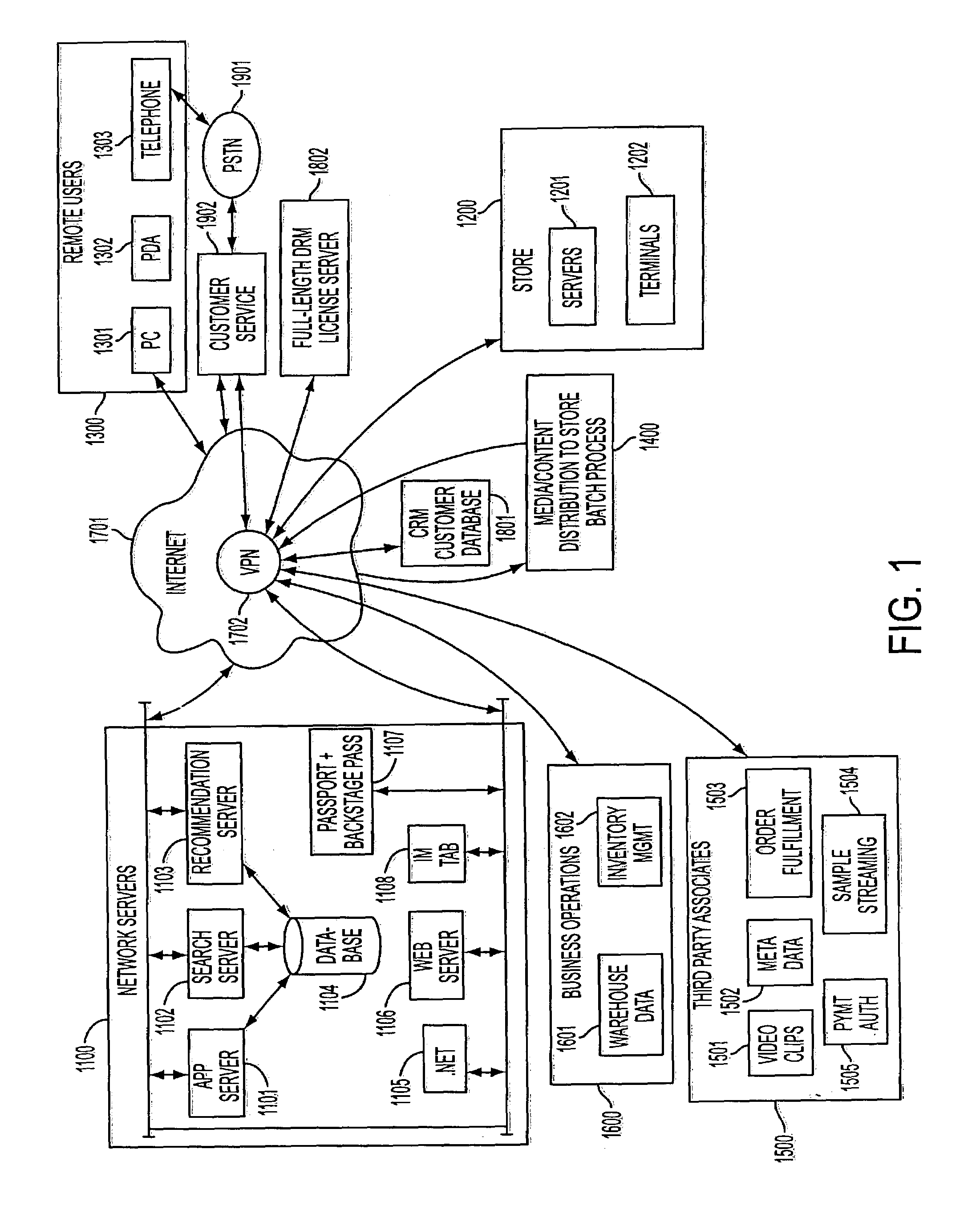

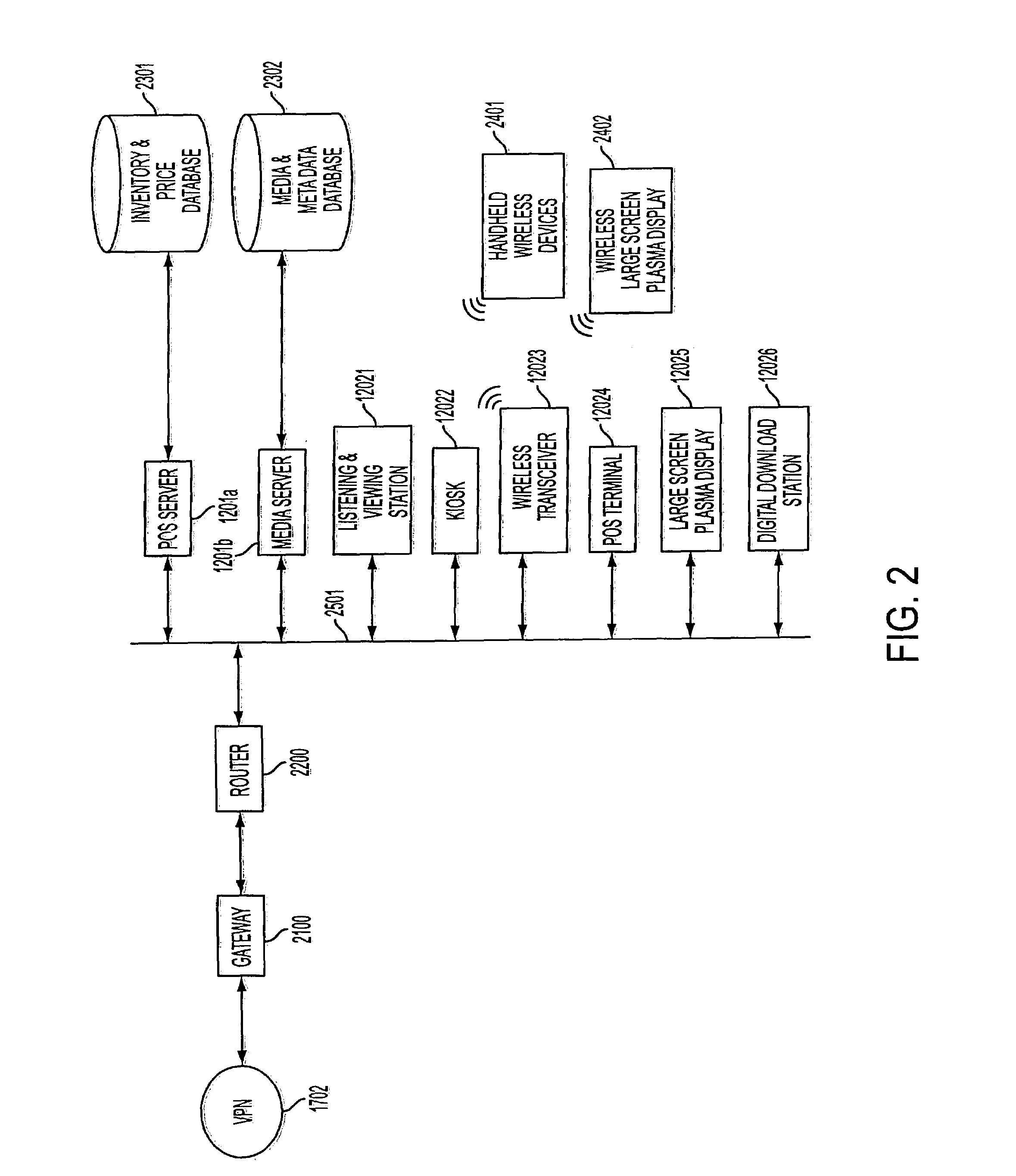

User-personalized media sampling, recommendation and purchasing system using real-time inventory database

A user-personalized product sampling, recommendation and purchasing system uses customer identification numbers and associated customer profile data to tailor specific product recommendations to a customer at a content sampling station of a retail location. The customer also can use her customer profile to receive the same information from an Internet website of the merchant. In-store sampling stations also may have the capability of checking store inventory and central warehouse inventory and providing recommendations to the customer in accordance with product availability, and optionally may provide the customer with the ability to place product orders directly through the sampling station. The recommendation system also can be used to tailor product recommendations in accordance with a rule-based model and real-time inventory data from a POS database.

Owner:TRANS WORLD NEW YORK

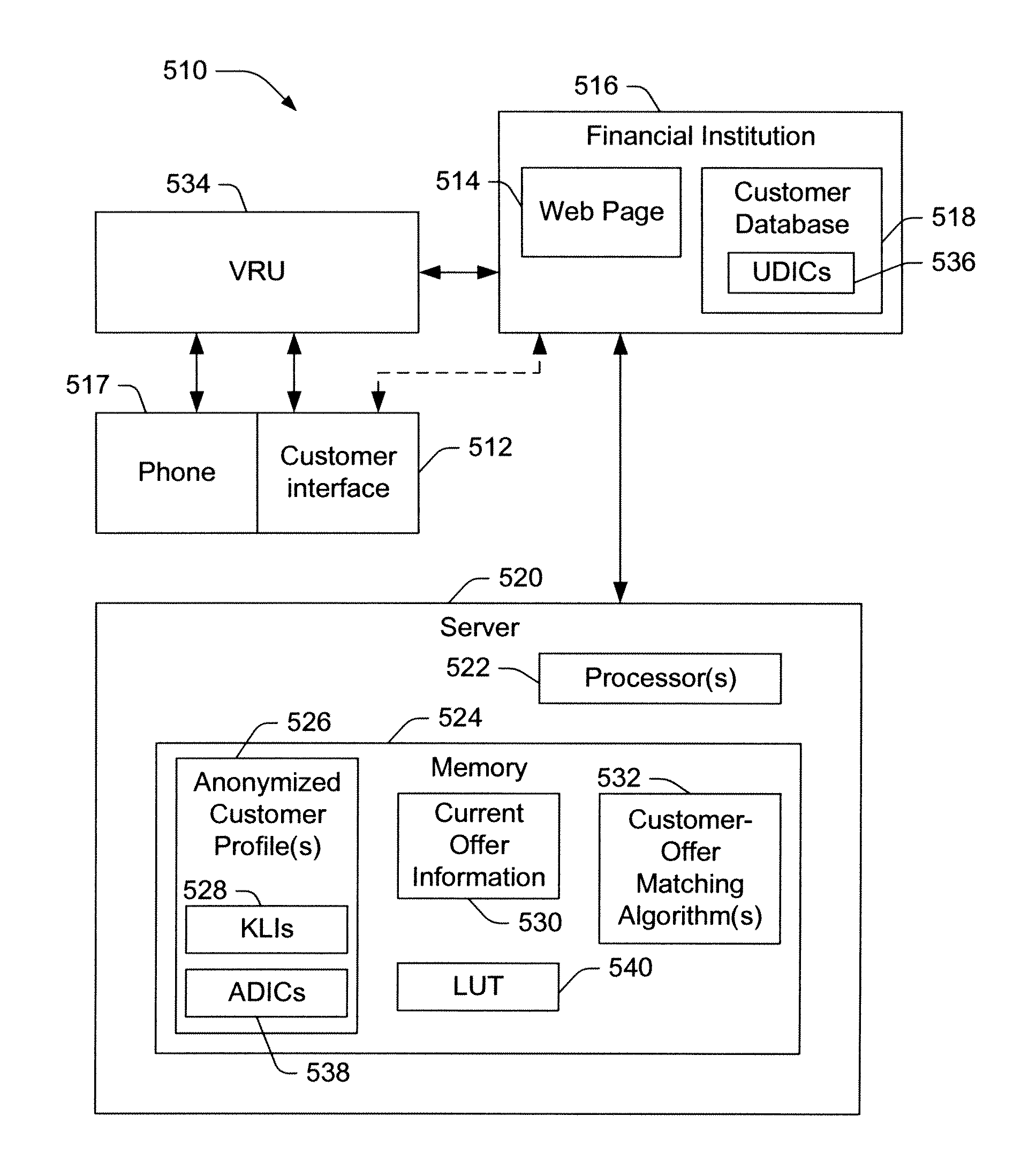

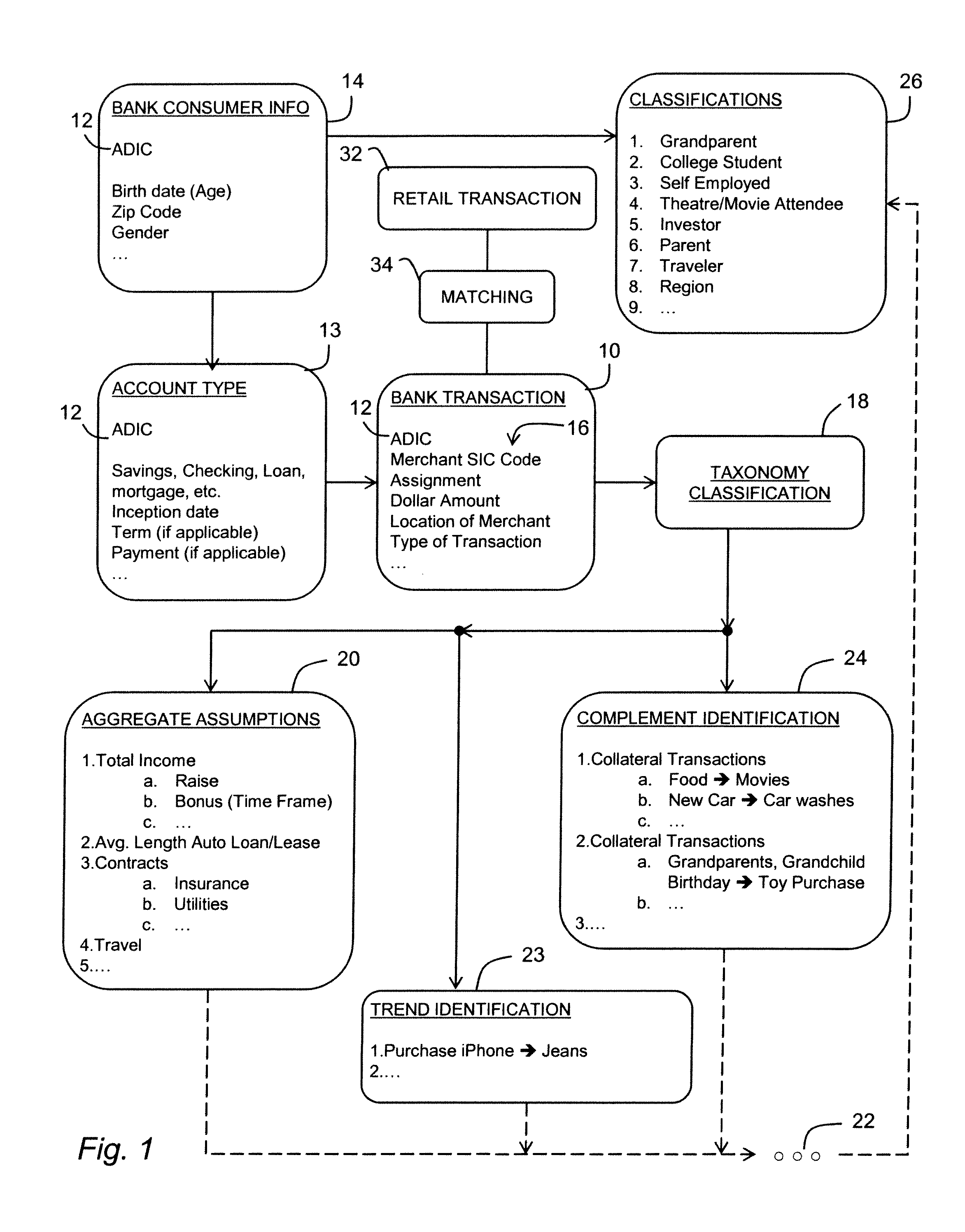

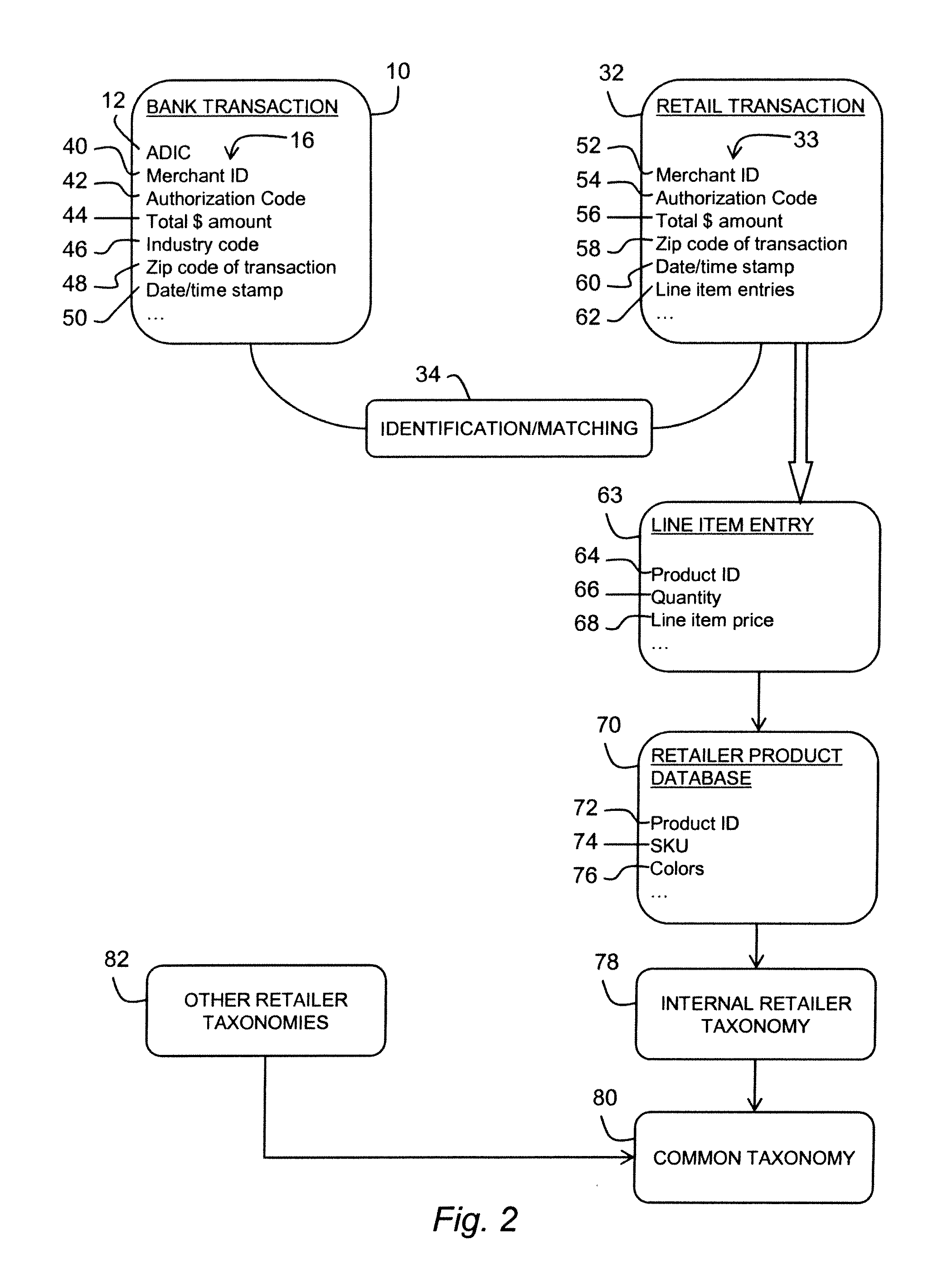

Targeted marketing to on-hold customer

Systems and methods are described for delivering targeted content to a customer through a voice response unit (VRU). When the customer calls into the VRU, the customer is prompted to enter identification information. A unique customer identification code (UCIC) associated with the customer is used to look up an anonymized customer profile stored by a third party server. An advertisement identification code (ADIC) associated with the anonymized customer profile is used to identify targeted offers for the customer. The customer is then informed of the targeted offers verbally by the VRU. Optionally, the customer is presented with details of the offer verbally via the VRU. According to another aspect, the customer can select alternate media for delivery of the offer details (e.g., email, text message, etc.).

Owner:SEGMINT INC

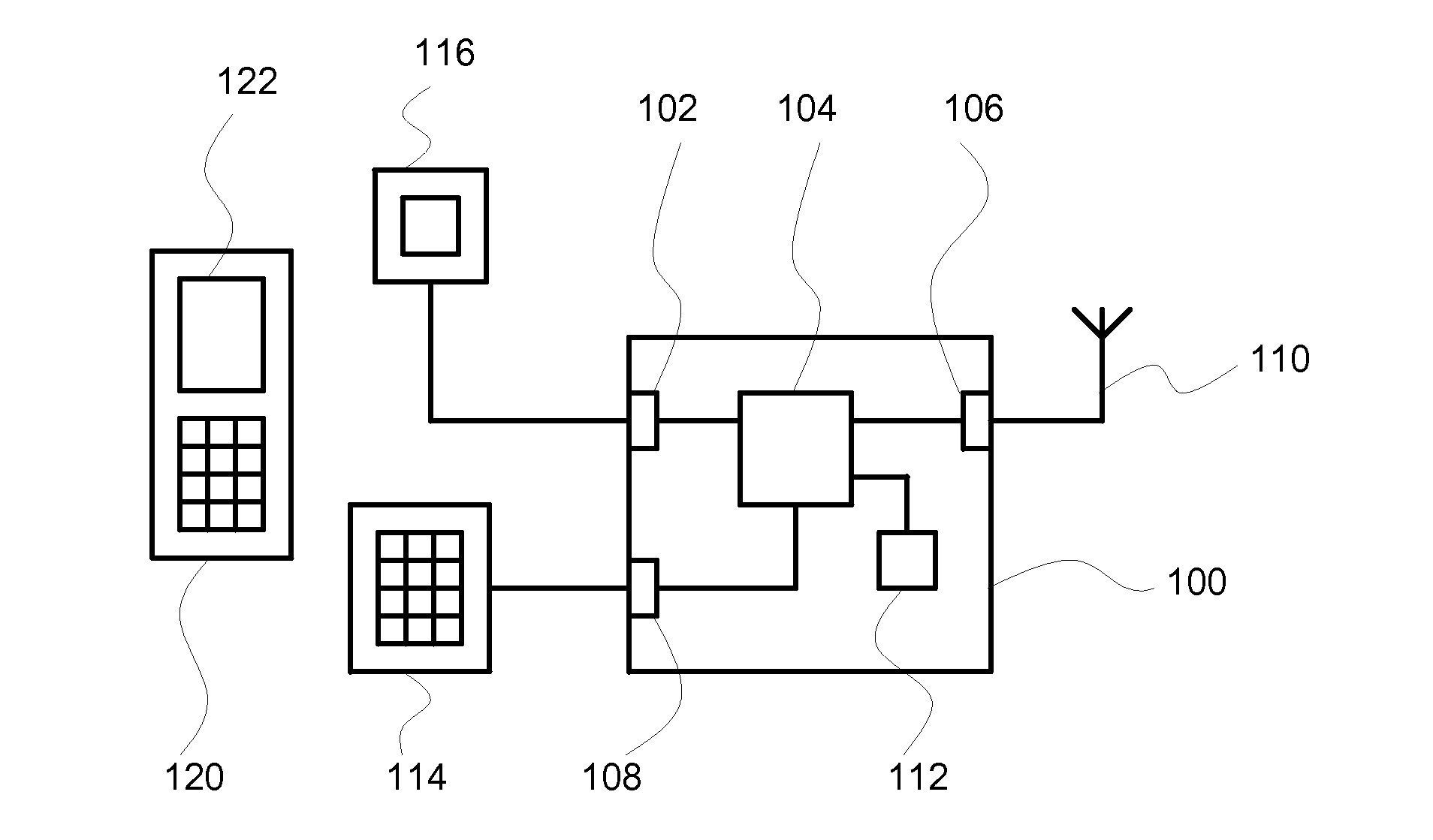

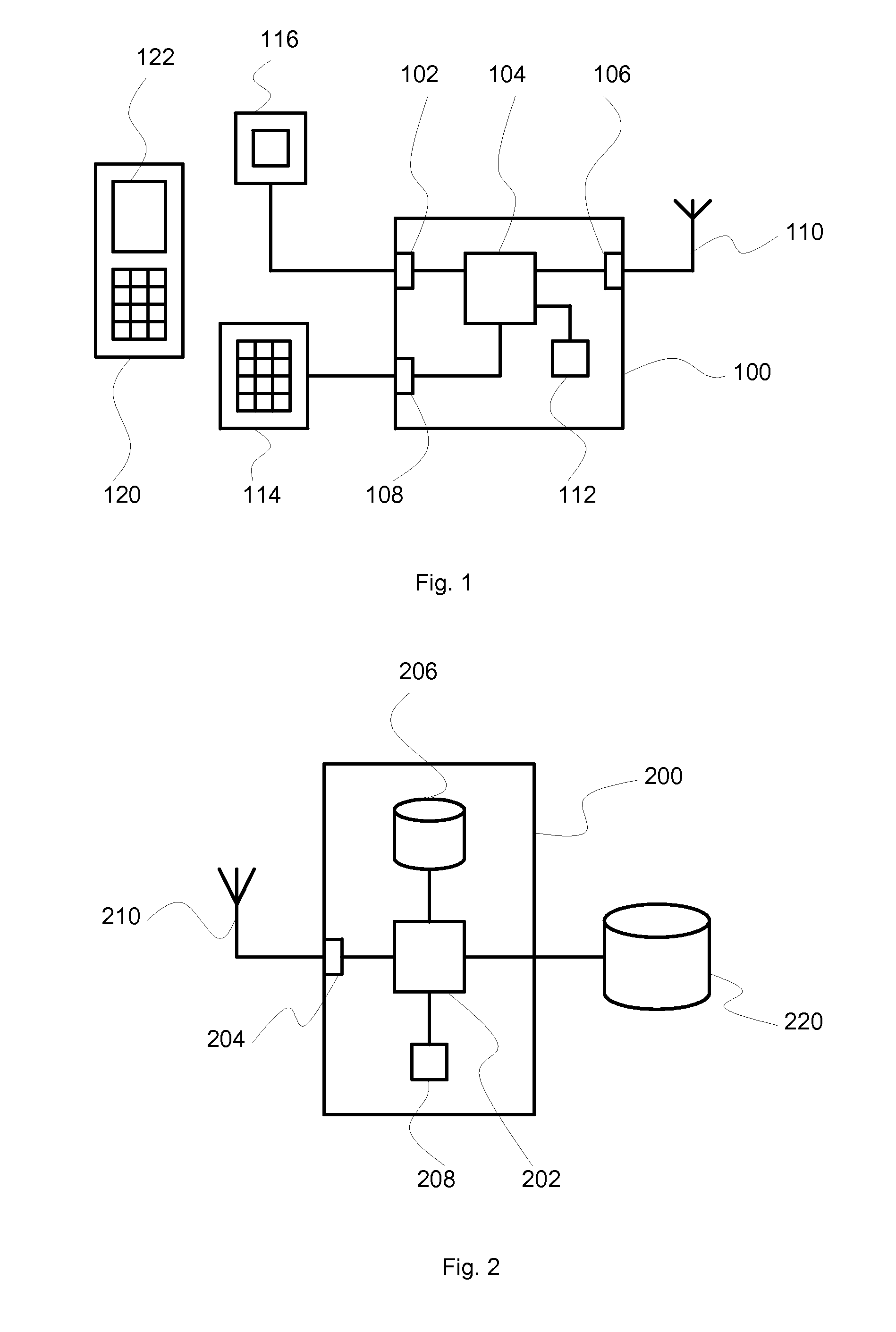

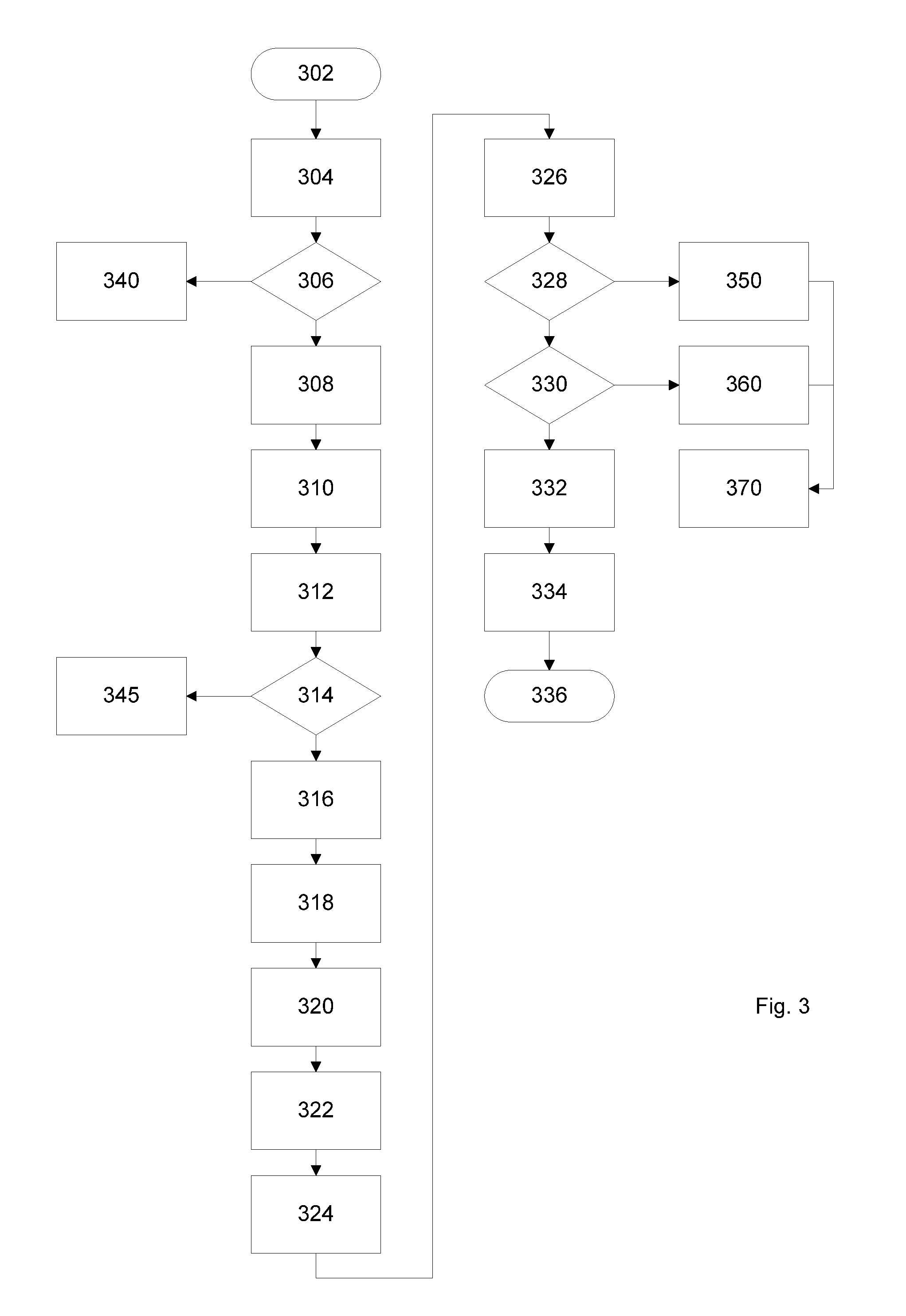

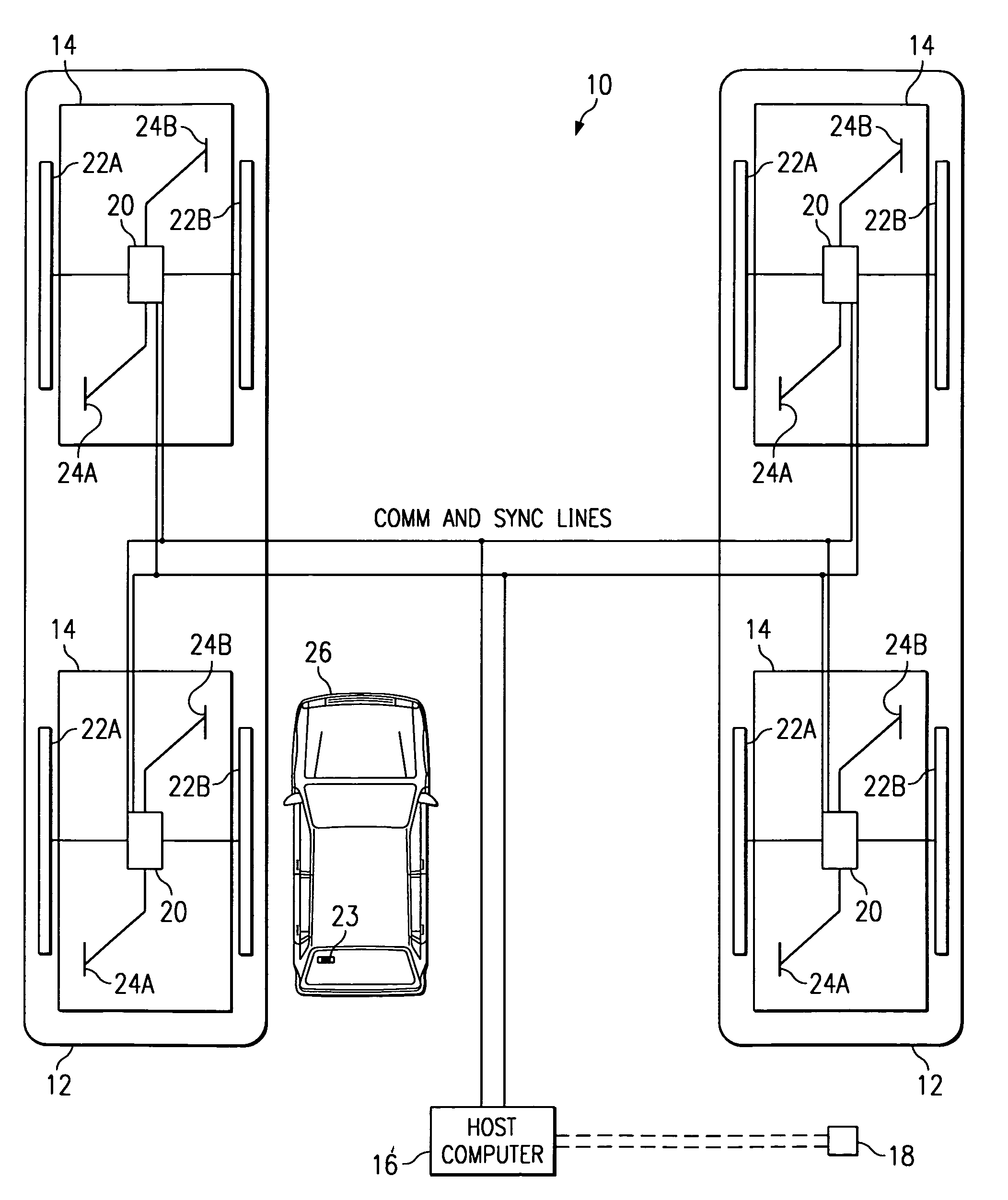

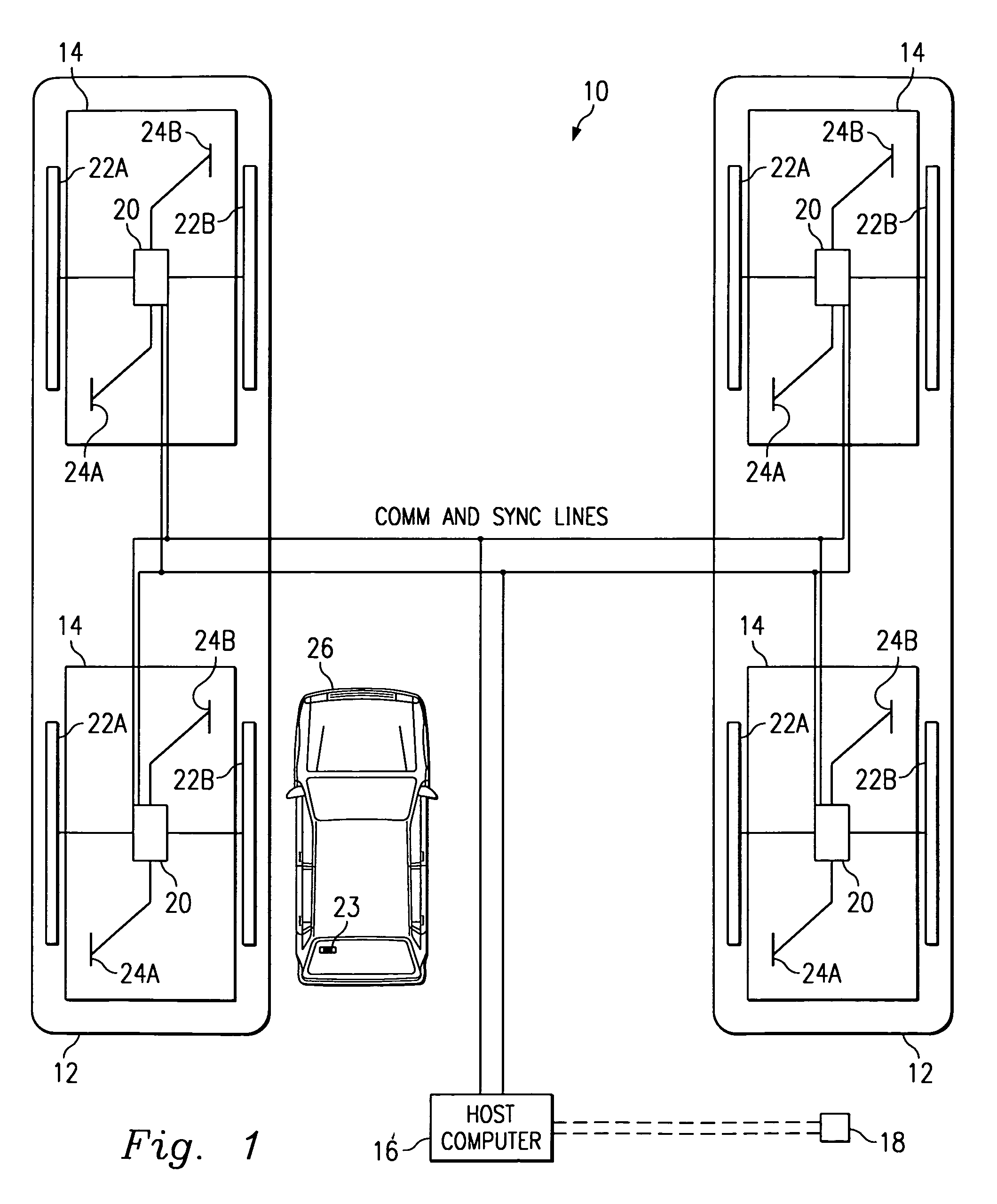

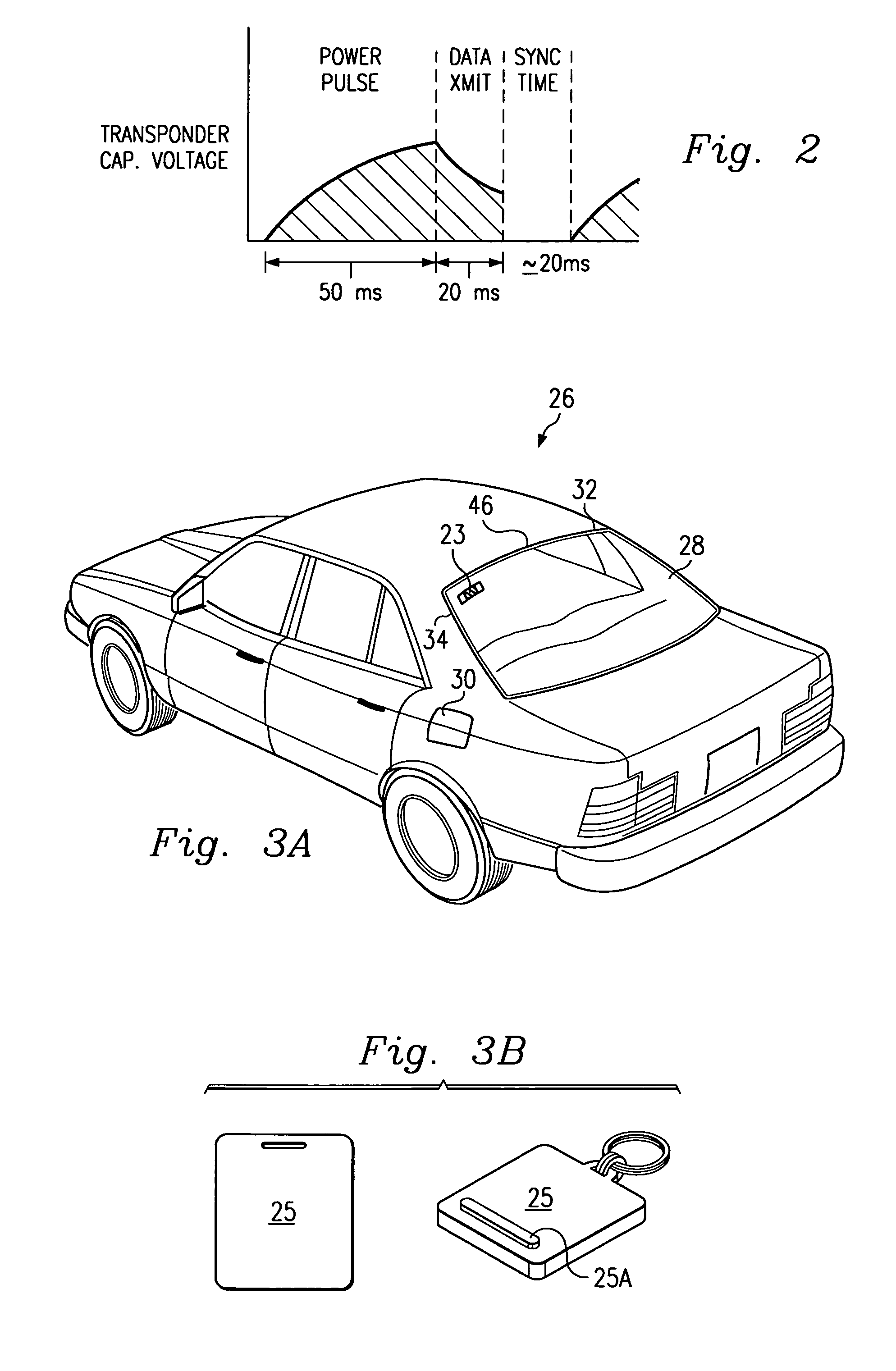

Dispensing system and method with radio frequency customer identification

InactiveUS7640185B1Easy to integrateProvide flexibilityFinanceCash registersRadio frequency signalEngineering

A system and method for providing a fuel dispenser with radio frequency customer identification capabilities. The system and method determines whether a transponder containing customer identification data is within range of a dispenser, the dispenser requiring activation by the customer to initiate a transaction and including a reader associated therewith for emitting radio frequency signals within the dispenser range, and for receiving customer identification data from the transponder responsive to the emitted radio frequency signals received by the transponder. When the transponder is within range of the dispenser, an in-range indication is provided to the customer. A determination is made whether the dispenser has been activated by the customer following a determination that the transponder is within the dispenser range. Upon activation of the dispenser following the determination that the transponder is within the dispenser range, the customer identification data received by the reader is associated with a transaction at the activated dispenser, whereupon the transaction at the activated dispenser is permitted and charged to the customer according to the customer identification data. The system easily retrofits onto an existing, conventional fuel dispenser.

Owner:EXXONMOBIL CORP (US) +2

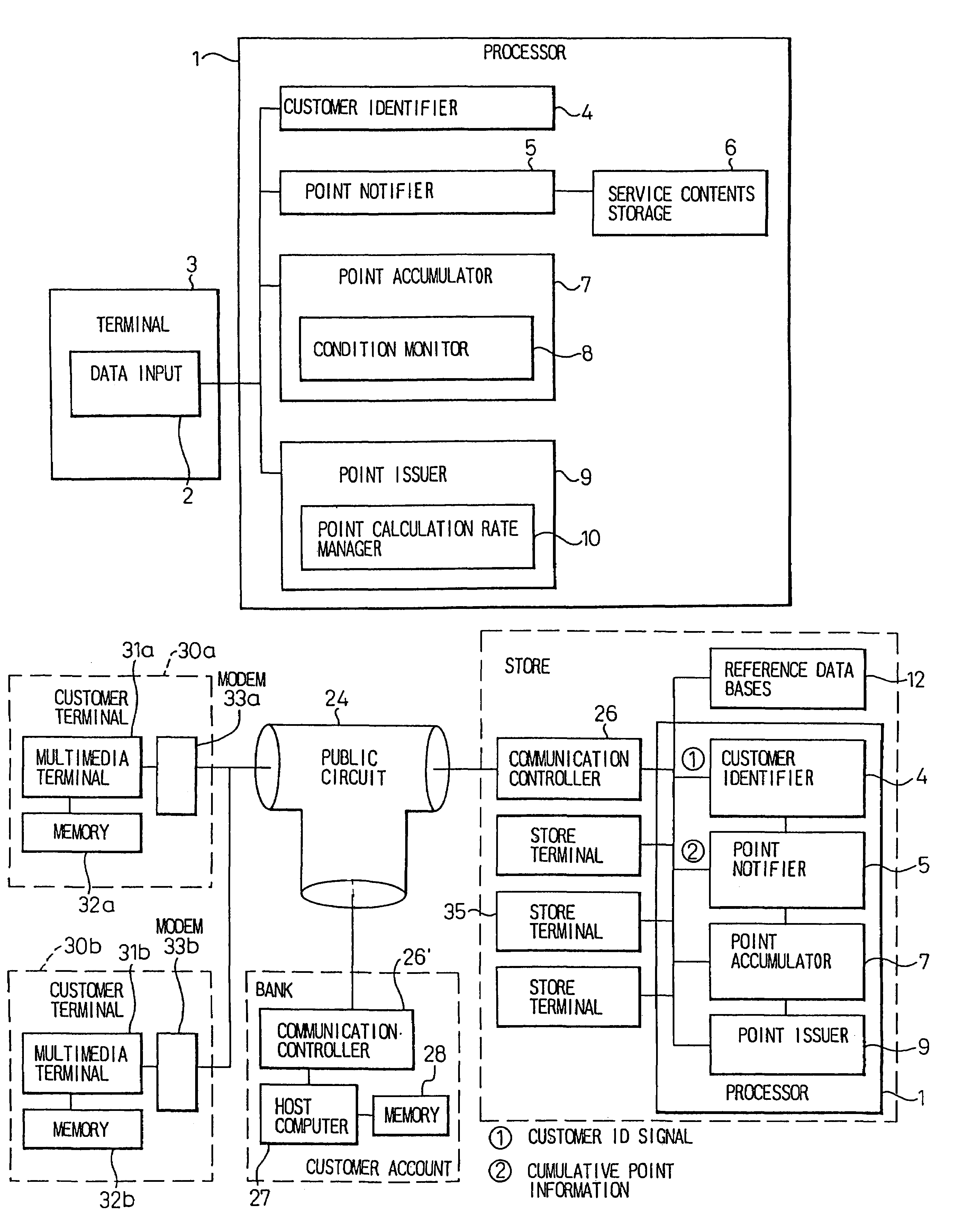

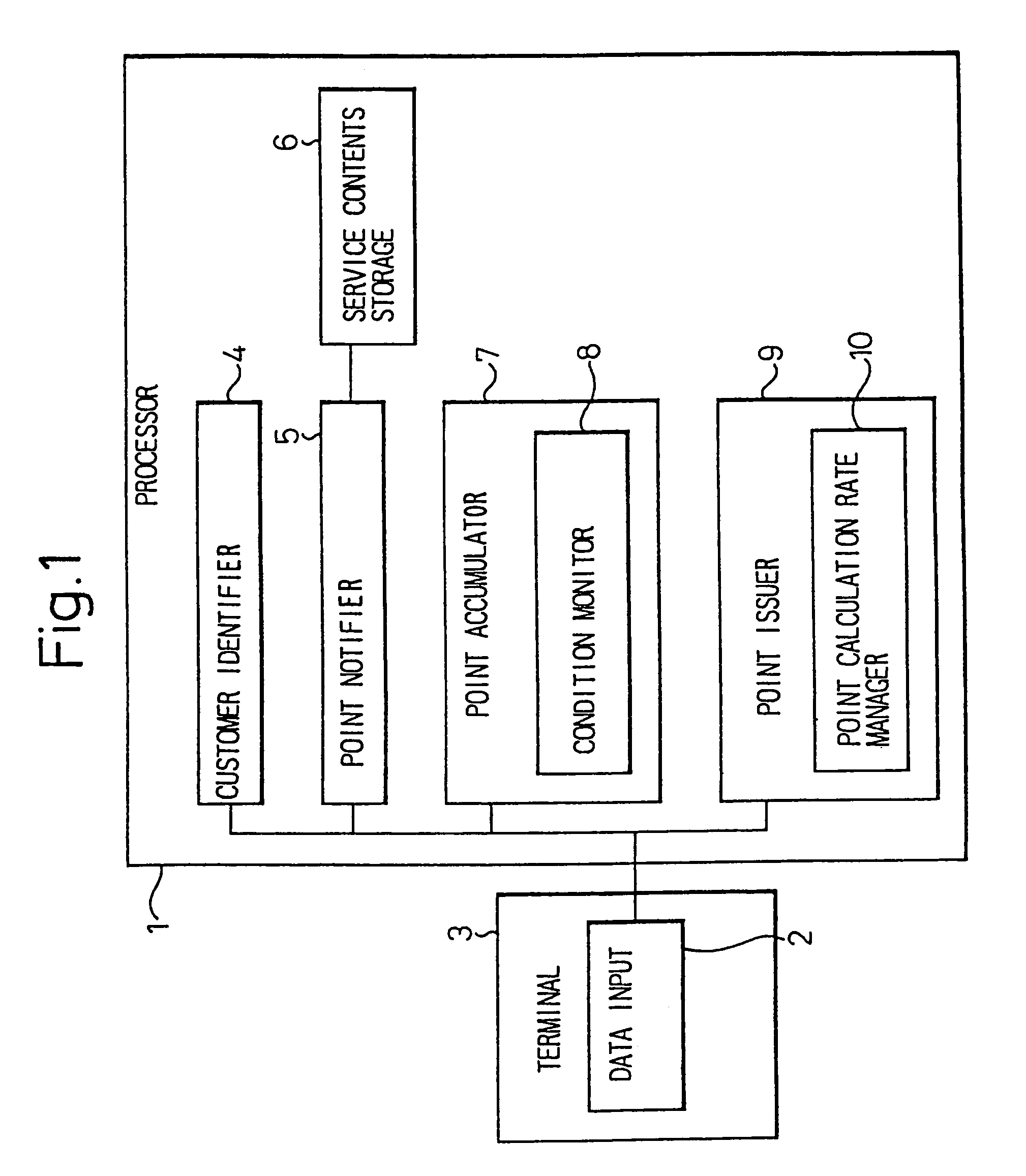

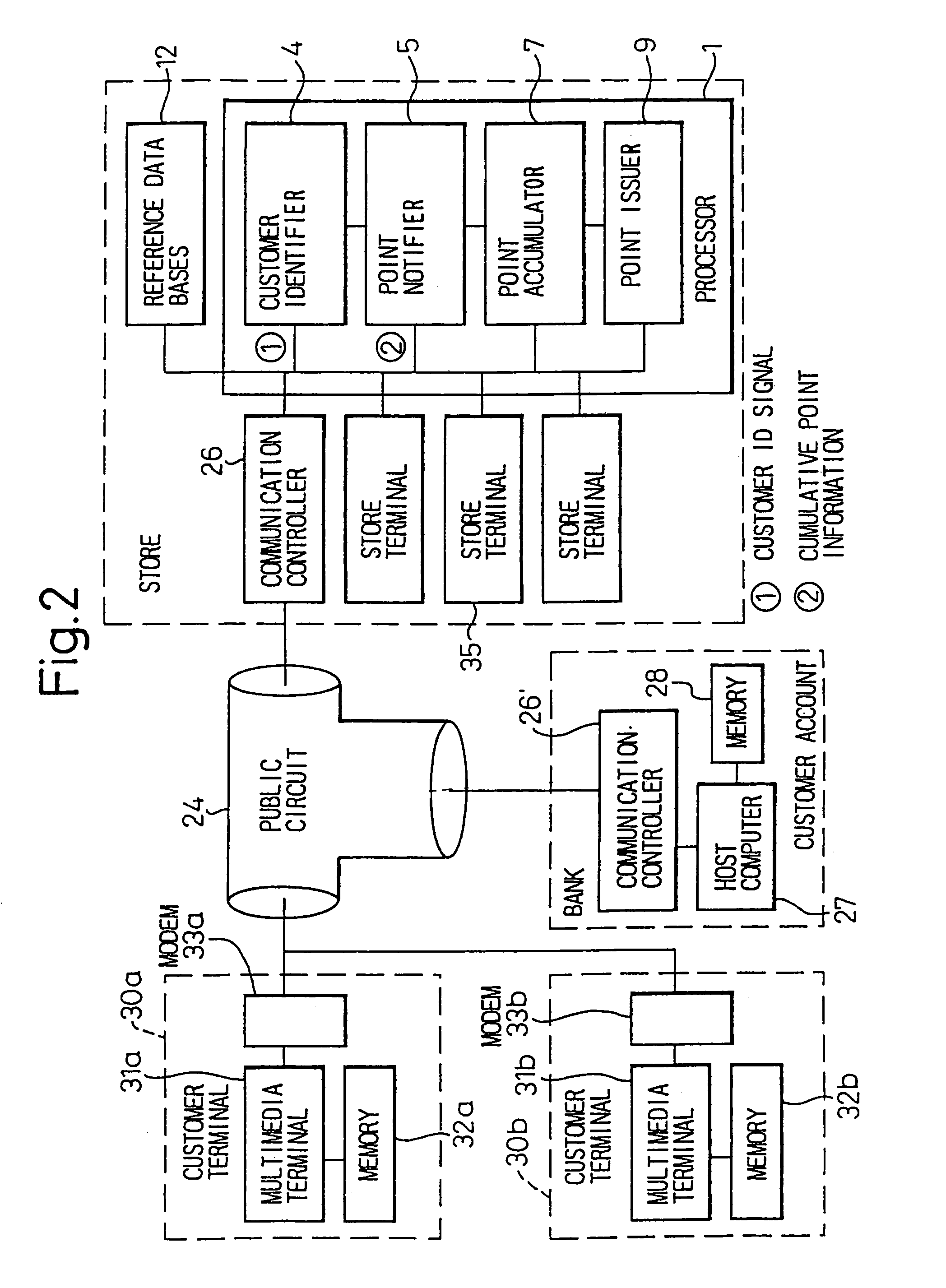

Service point management system for use in sales promotion services

InactiveUS6965869B1Increase salesSimple methodCash registersReceipt giving machinesService product managementIT service management

A service point management system employs a computer for managing points issued to each customer who receives service according to the points. A point issue unit issues points to the customer according to transactions performed by the customer. A point accumulation unit calculates and accumulates the issued points. A point notification unit notifies the customer of point information. A customer identification unit identifies the customer according to customer identification data entered through a customer or store terminal. The point notification unit notifies the customer identified by the customer identification unit of the customer's cumulative point information before the customer carries out transactions.

Owner:FUJITSU LTD

Passive biometric customer identification and tracking system

InactiveUS7175528B1Simplifies search techniqueMinimal useDiscounts/incentivesCharacter and pattern recognitionPersonal identification numberBiometric data

A computer-based customer tracking system passively identifies customers. Acquired biometric identification information is sent to a computer processor, which searches files in a library for matching biometric data. If no match is found, the processor opens a new file in the library. If a match is found, said processor stores in the file that a repeat identification has occurred. If said processor is only able to reduce the number of possible matches to two or more files, personnel determines if a match certain has occurred. If prior activity information stored in the file exceeds a predetermined level, the prior activity information is retrieved from the file and sent to a terminal, preferably at the location of the transaction. New information from the transaction is stored for future access. A selected or assigned personal identification number (PIN) reduces the time associated with, and improves the efficiency of, the identification process.

Owner:BIOMETRIC RECOGNITION

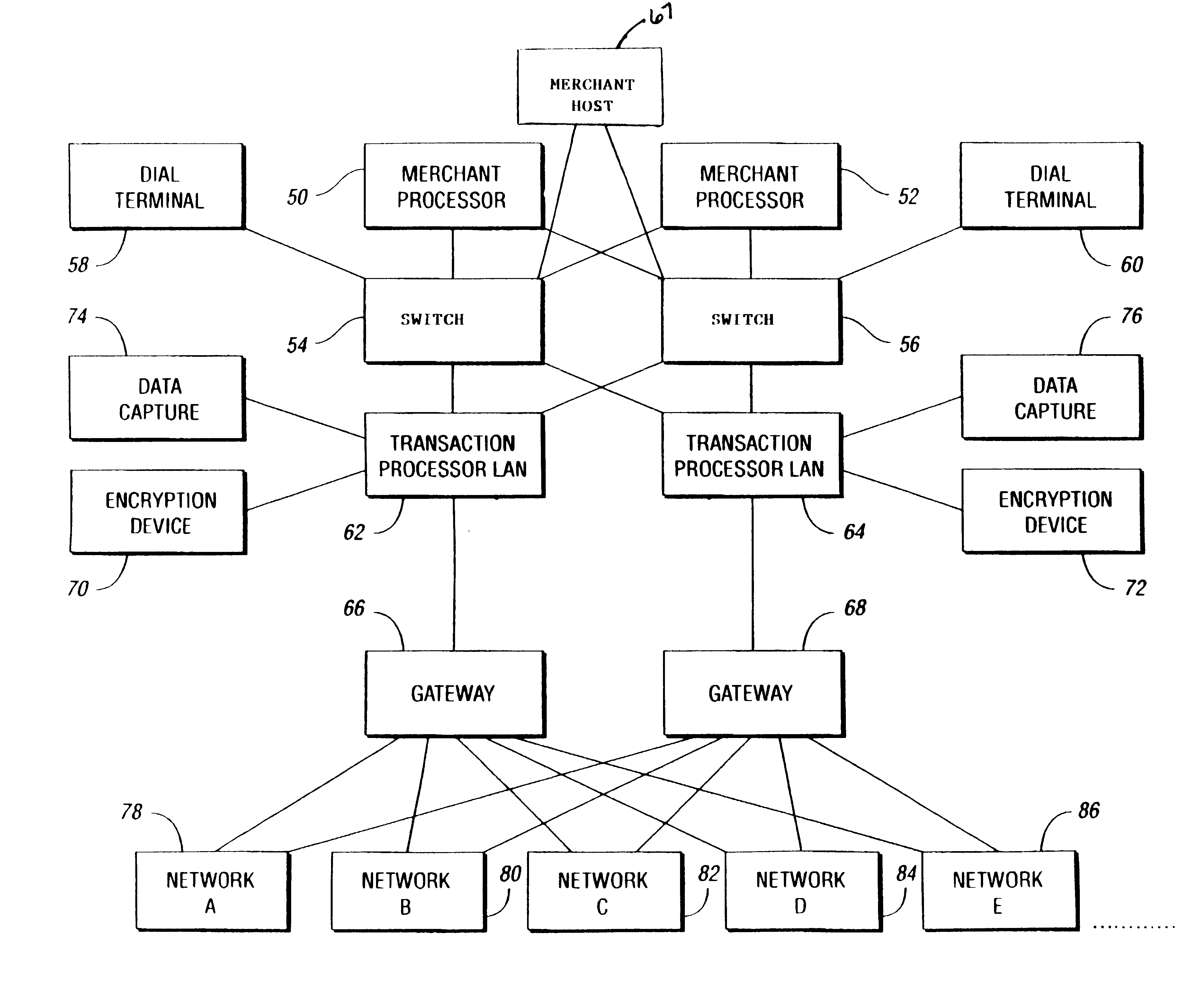

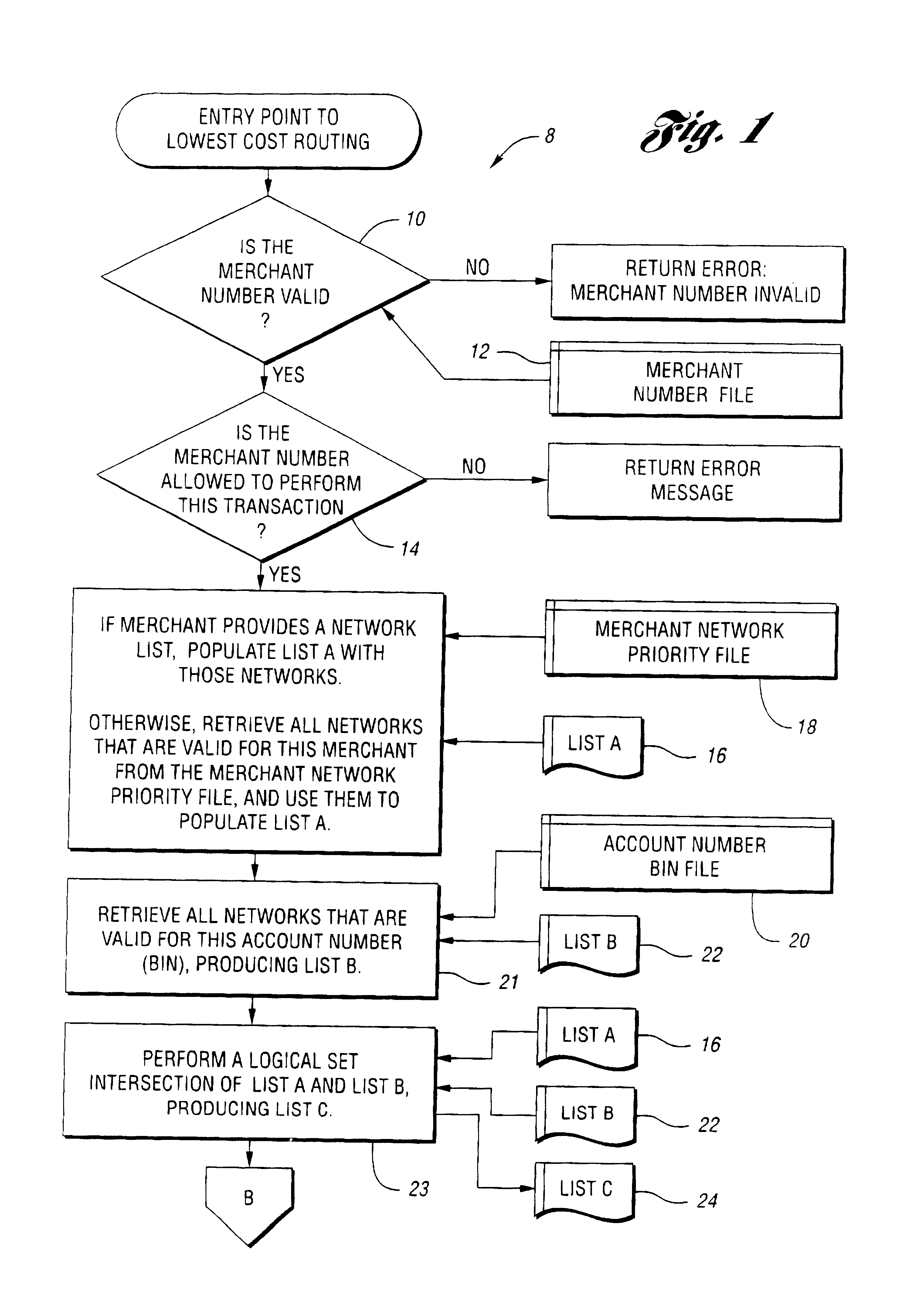

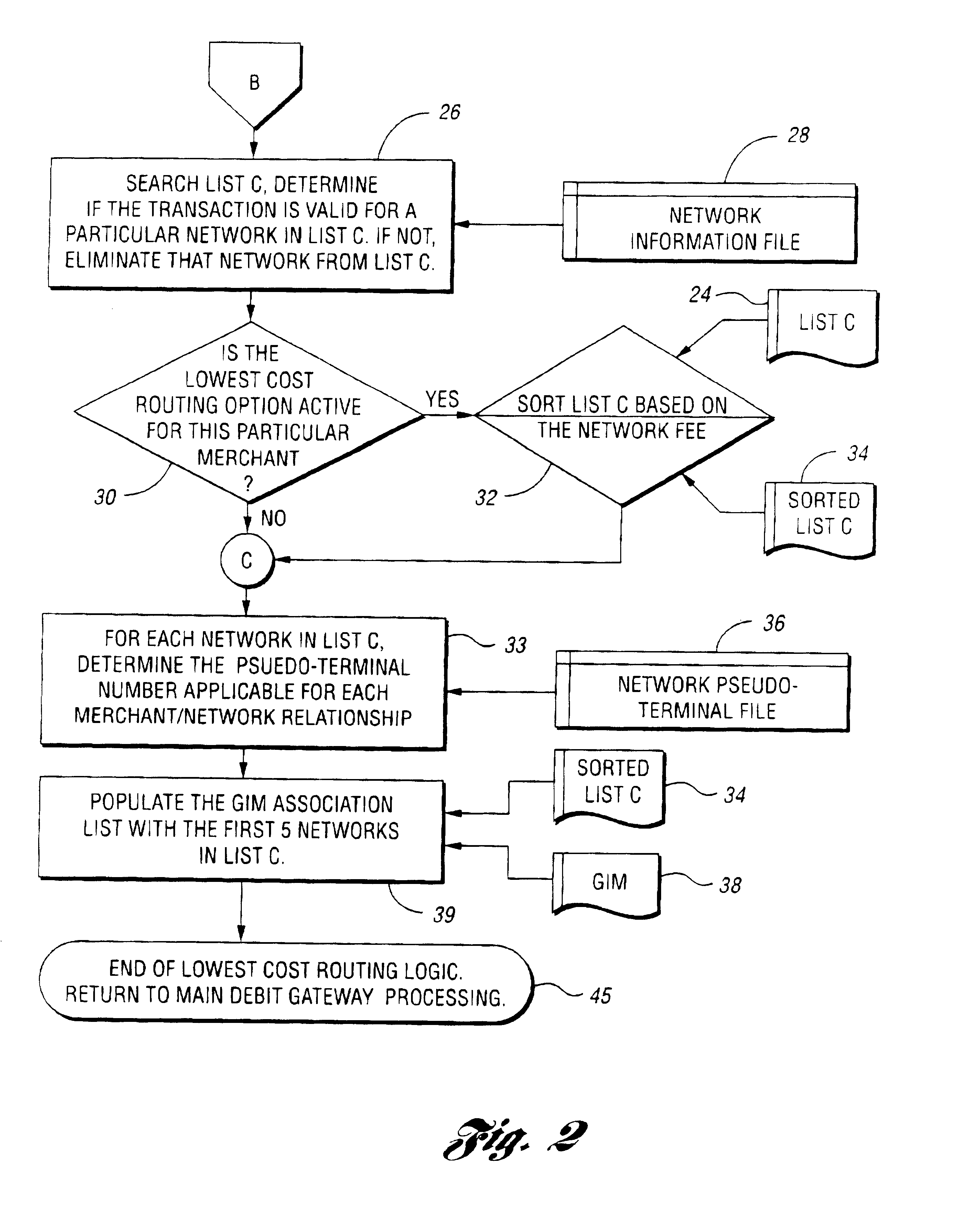

Method and system for reduced cost debit processing

InactiveUS6847947B1Low costReduce transactionFinancePayment circuitsCustomer identificationDistributed computing

A method is provided for processing debit transactions at the lowest cost available. The method is comprised of the following steps: providing a merchant identification number and an account number BIN file to a debit processing center; matching the merchant identification number against at least one merchant database at the debit processing center; providing a merchant network list from the at least one merchant database based upon the match of the merchant identification number; providing a customer network list from the at least one merchant database based upon the match of customer identification number; creating a merchant-customer network list by matching at least one common element from the merchant network list and the customer network list. Next the system determines the validity for each common element of the merchant-customer network list and eliminates each invalid common element from the merchant-customer network list. Subsequently, the system sorts the elements of the merchant-customer network list based on network fee and communicates with a routing and processing database to determine the routing and processing method for each merchant customer element. Finally, the system applies the lowest cost element for routing and processing a debit transaction.

Owner:FIRST DATA

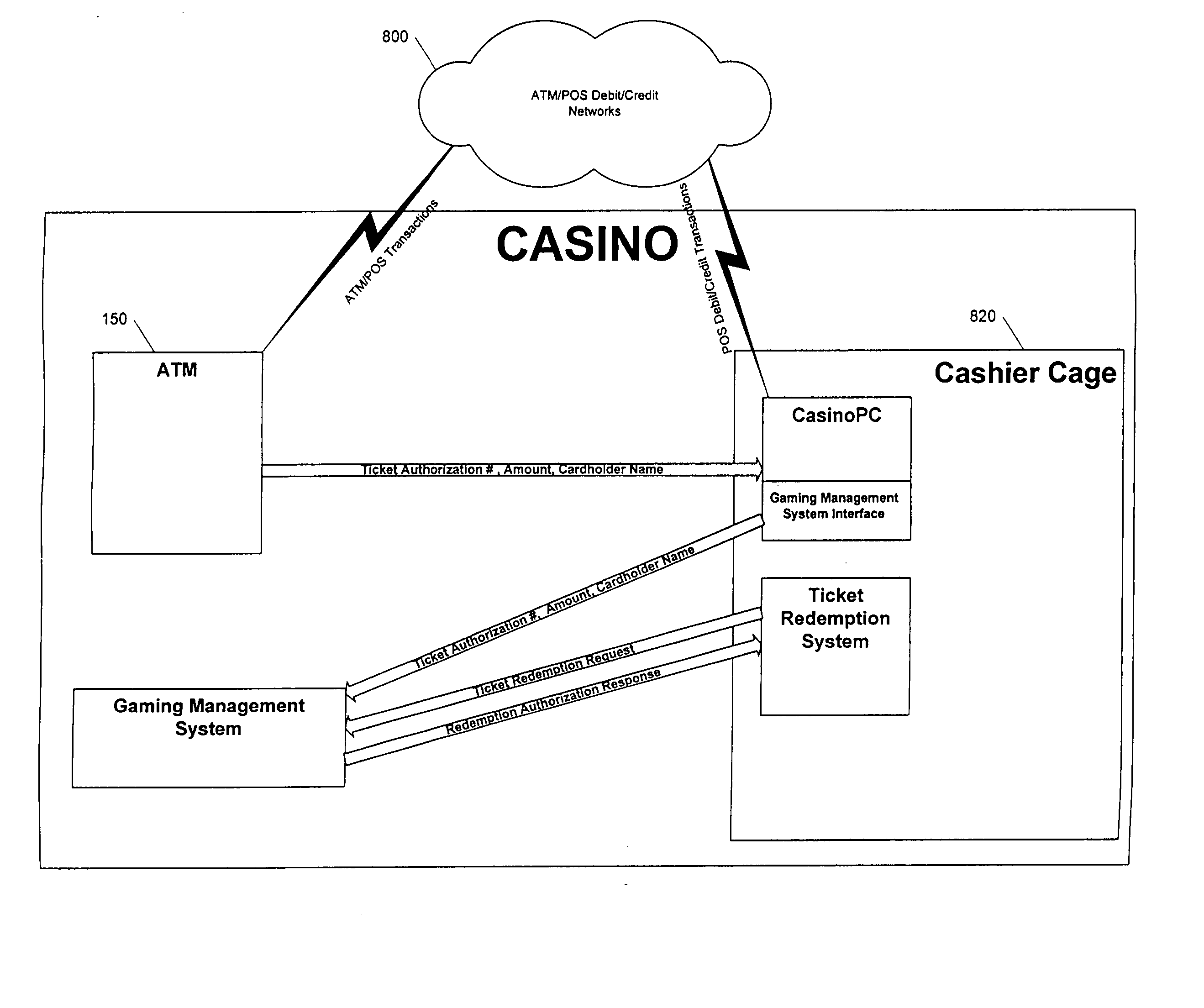

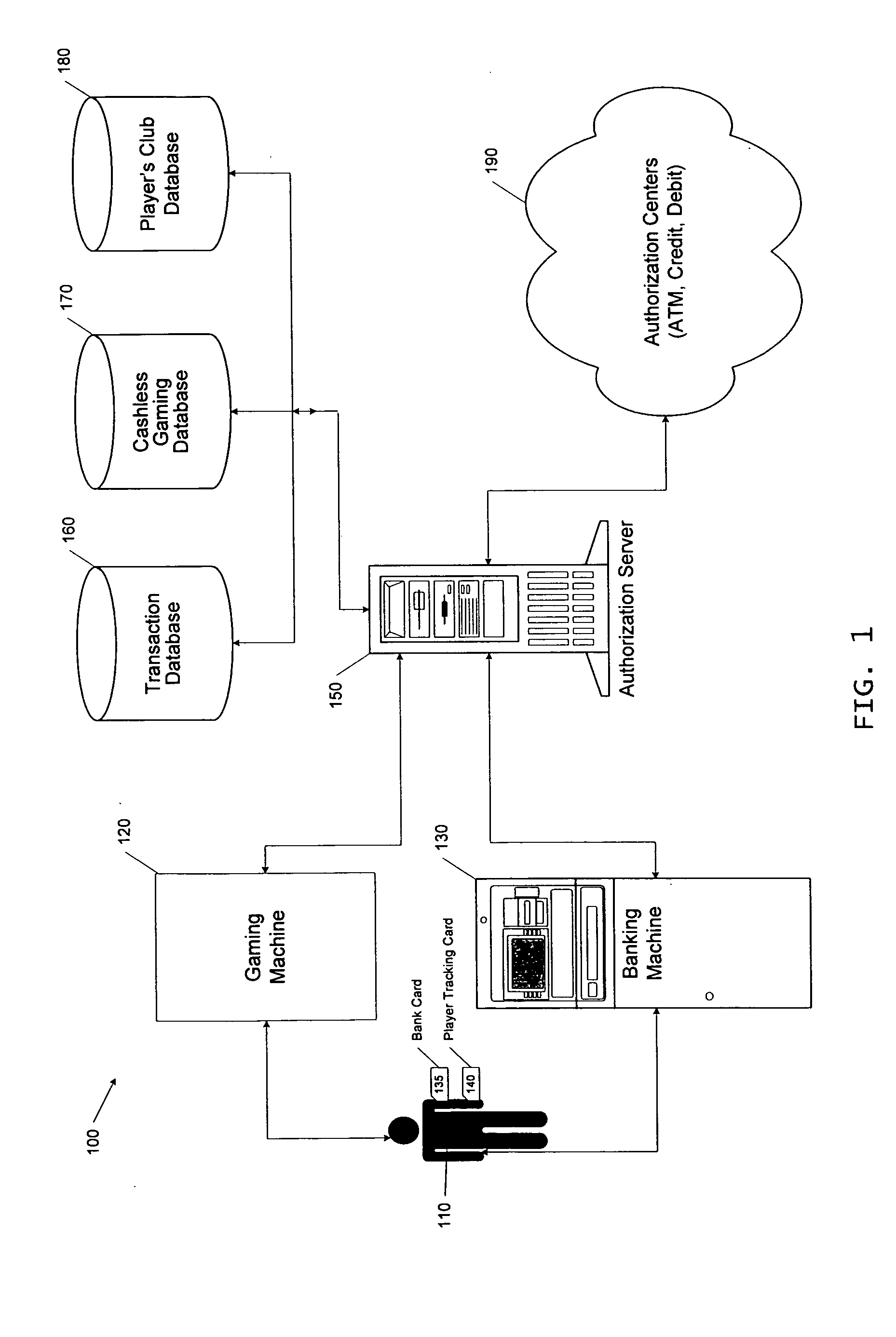

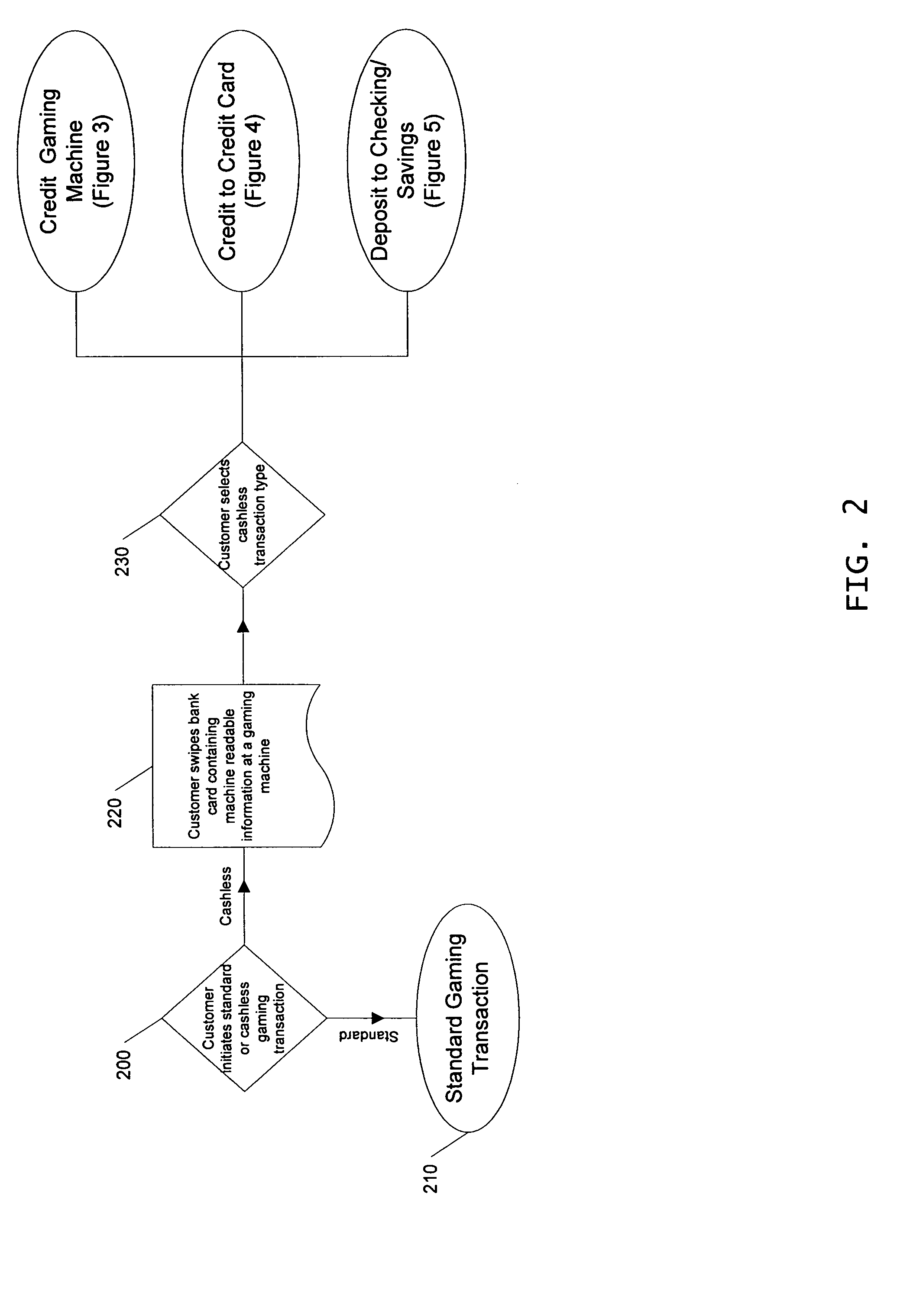

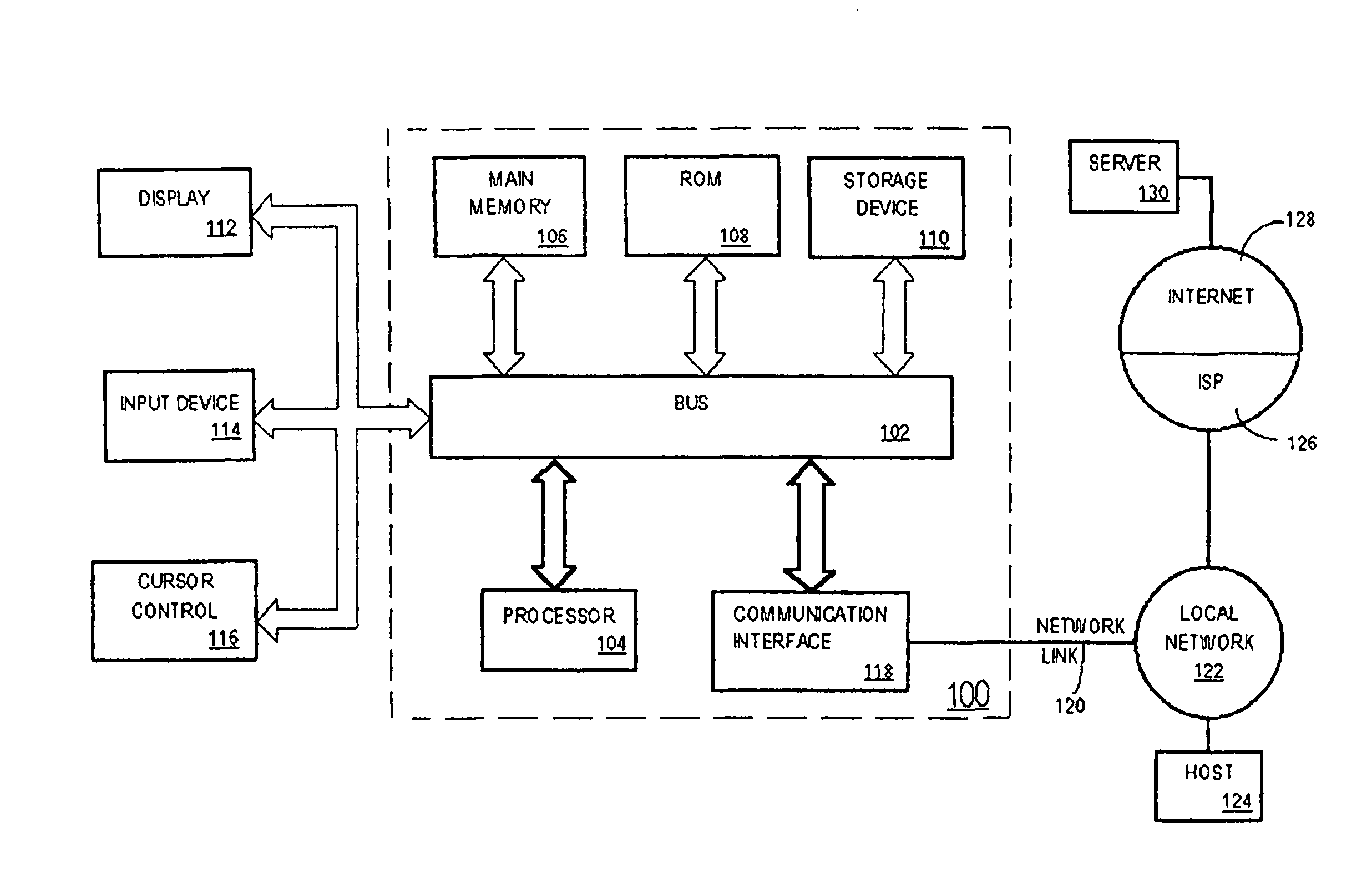

System and method for integrated player tracking and cash-access

ActiveUS20050107156A1Direct accessComplete banking machinesBoard gamesCredit cardFinancial transaction

The present invention relates to a system and method for integrating player tracking and cash access in a casino or other gaming environment. One aspect of the invention allows for fund access and management wherein gaming machines, such as slot machines, receive playable credits directly from a patron's banking or credit card account. Another aspect of the present invention relates to integrating player tracking and cash access transactions by allowing the players to provide a player tracking card for each financial transaction conducted in the casino. In return, the casino issues gaming or bonus points to the players for allowing their transactions to be tracked. Yet another aspect of the present invention consolidates the players' financial account information into a single casino database. Players can subsequently credit or debit cash from the players' financial accounts using any associated customer identification cards or otherwise receive such credits in other forms that permit negotiations, including quasi-cash documents.

Owner:EVERI PAYMENTS

System and method for verification of identity for transactions

Billing a customer through an intermediary billing system for a transaction by receiving, at the intermediary billing system, a transaction request associated with a transaction amount and a customer identification code, validating, in the intermediary billing system, the transaction request by determining whether the customer identification code corresponds to a customer that is registered with the intermediary billing system, and sending, in the case that the transaction request is valid, a billing event trigger associated with the customer identification code to an external billing mechanism, the billing event trigger representing the transaction amount.

Owner:SMS AC INC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com