Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

2563 results about "Customer information" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Method, system, and computer program product for linking customer information

InactiveUS20070192122A1Customer relationshipDigital data processing detailsCustomer informationInformation data

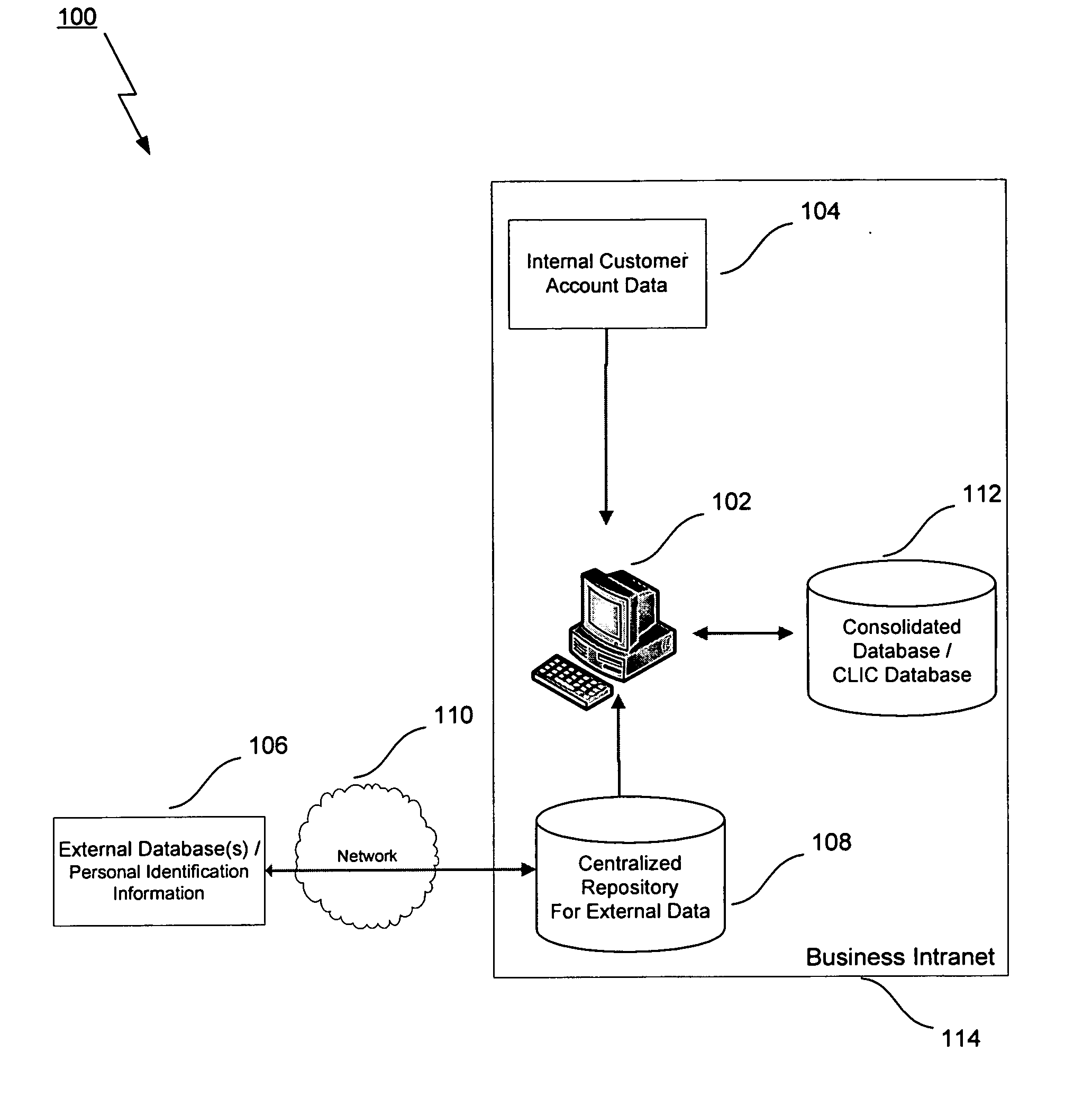

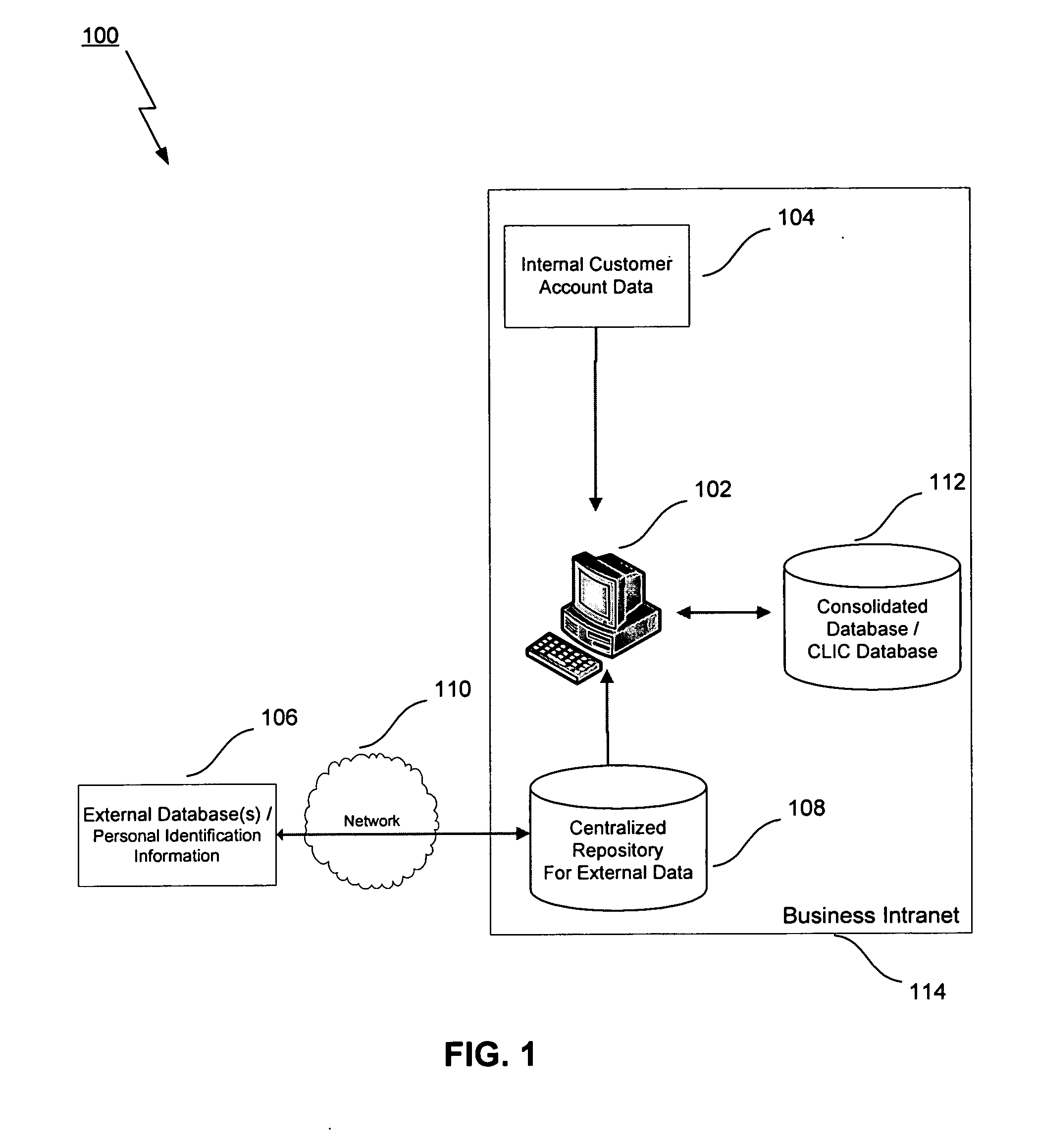

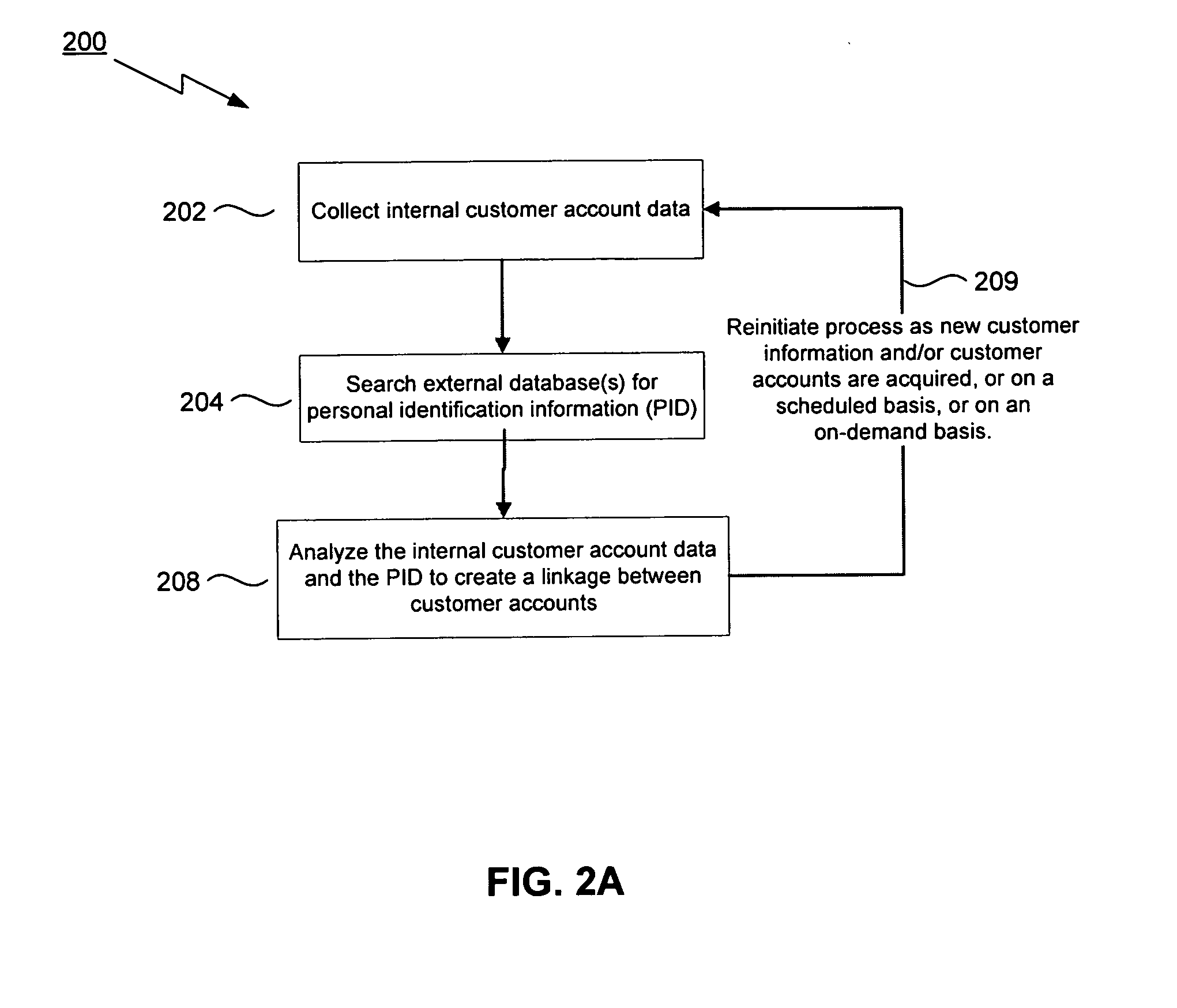

In a business where a database tracks customers and manages customer accounts, a method and system correctly link accounts with customers. The method entails reading customer information for a first customer and for a second customer, and then utilizing personal identification information obtained from other sources to determine if the first customer is the same as the second customer. If the first customer and the second customer are the same person, the first customer and the second customer are identified as being the same unique person. Accounts associated with the two customers are identified as belonging to the same unique person. Viewed another way, the method and system of the present invention takes an existing database of personal identification information, and cross-references that database against other sources of personal identification information to identify persons who appear to be separate persons, but who are actually one and the same individual.

Owner:LIBERTY PEAK VENTURES LLC

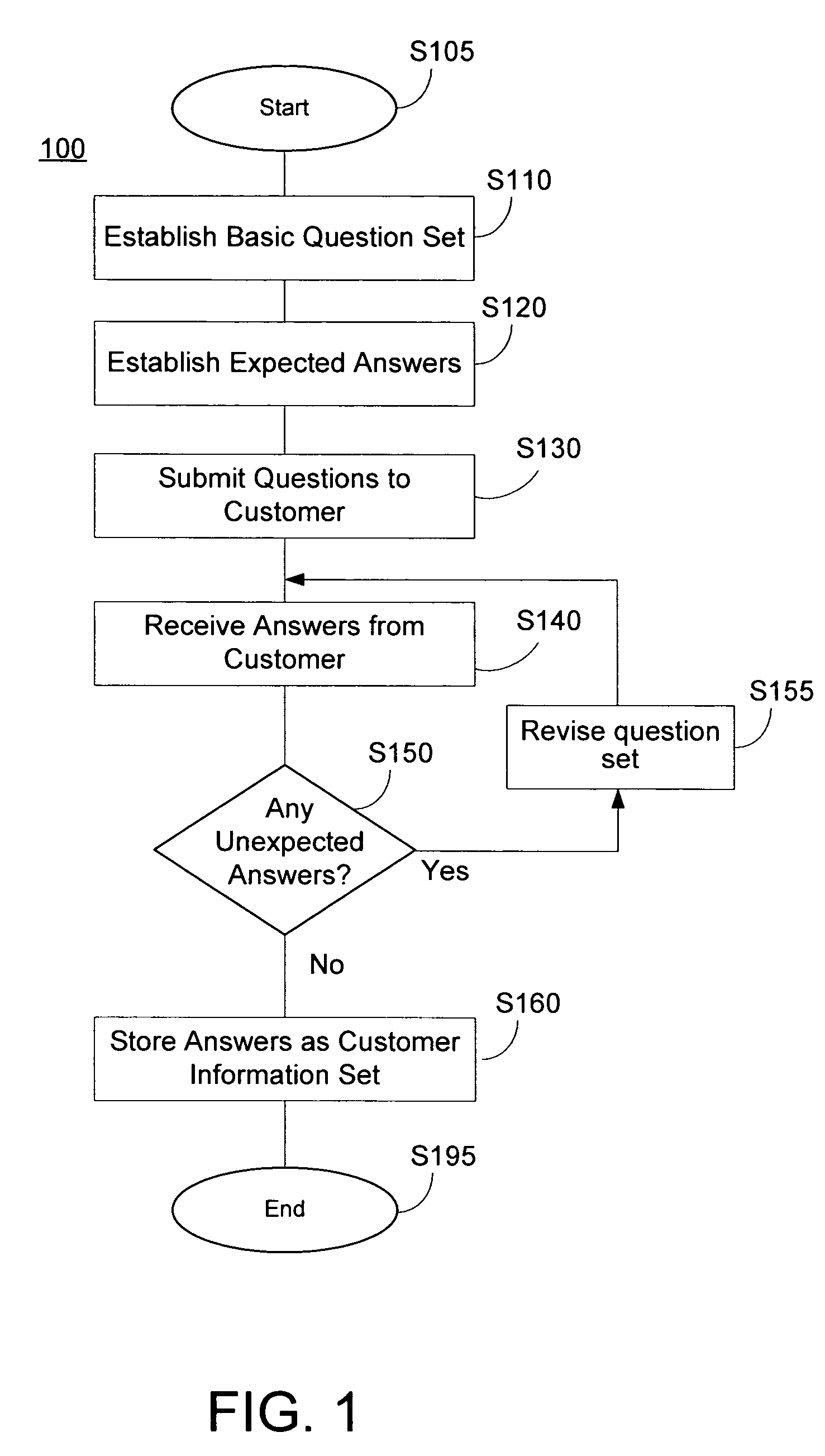

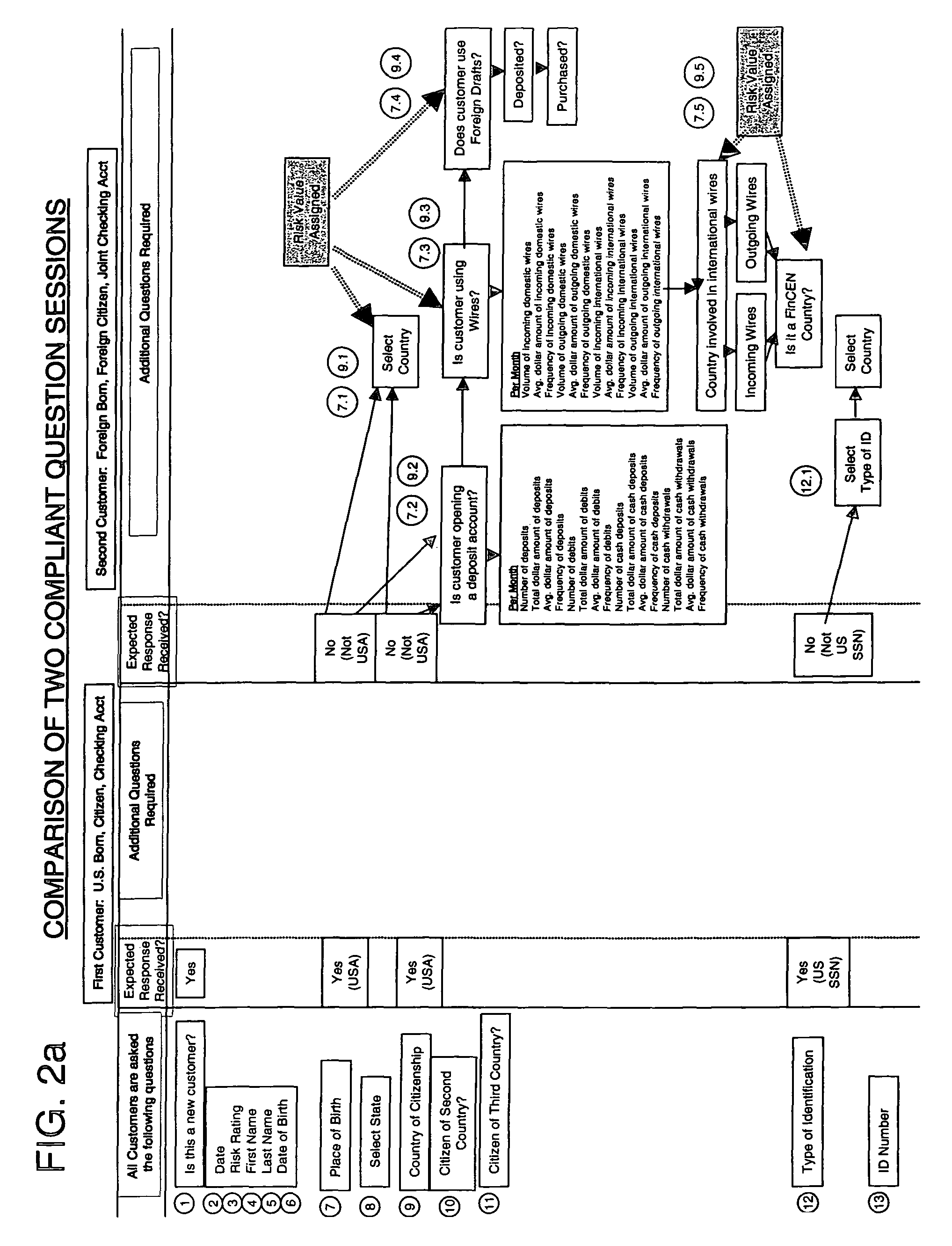

System and method for conducting an optimized customer identification program

Owner:THE PNC FINANCIAL SERVICES GROUP

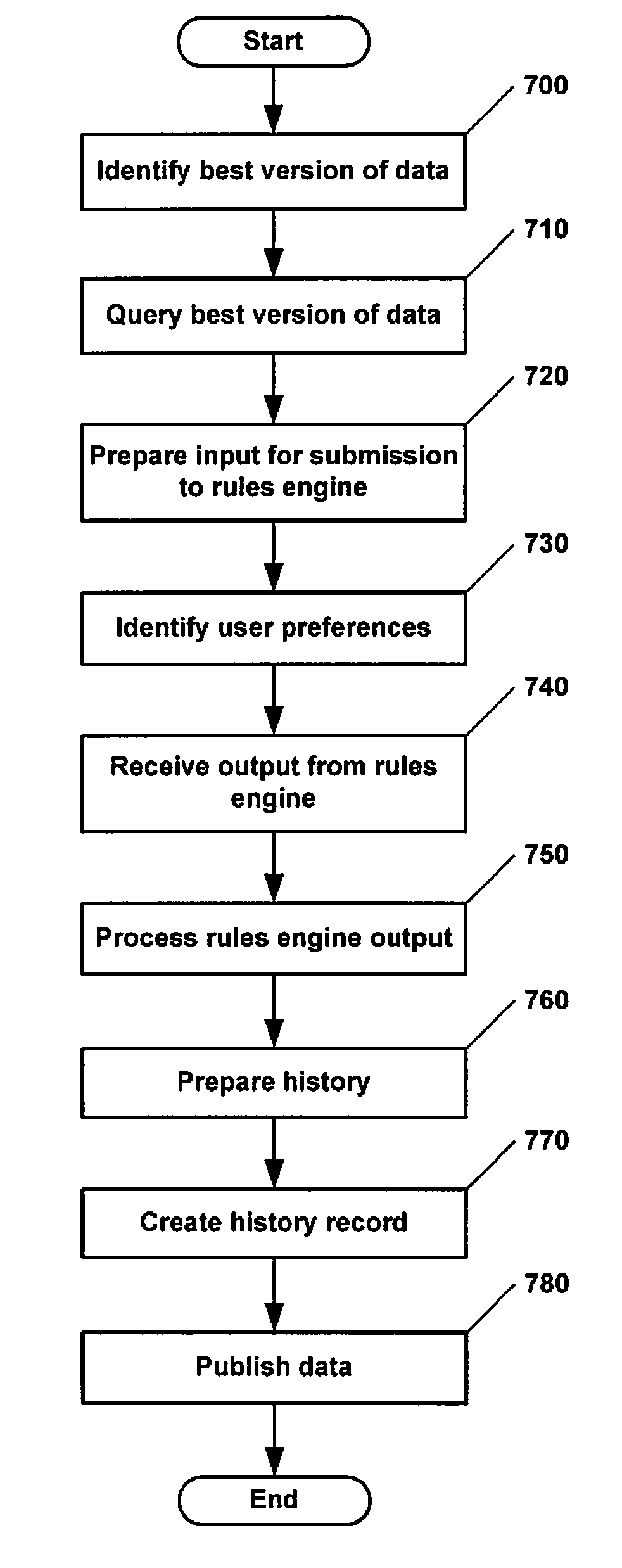

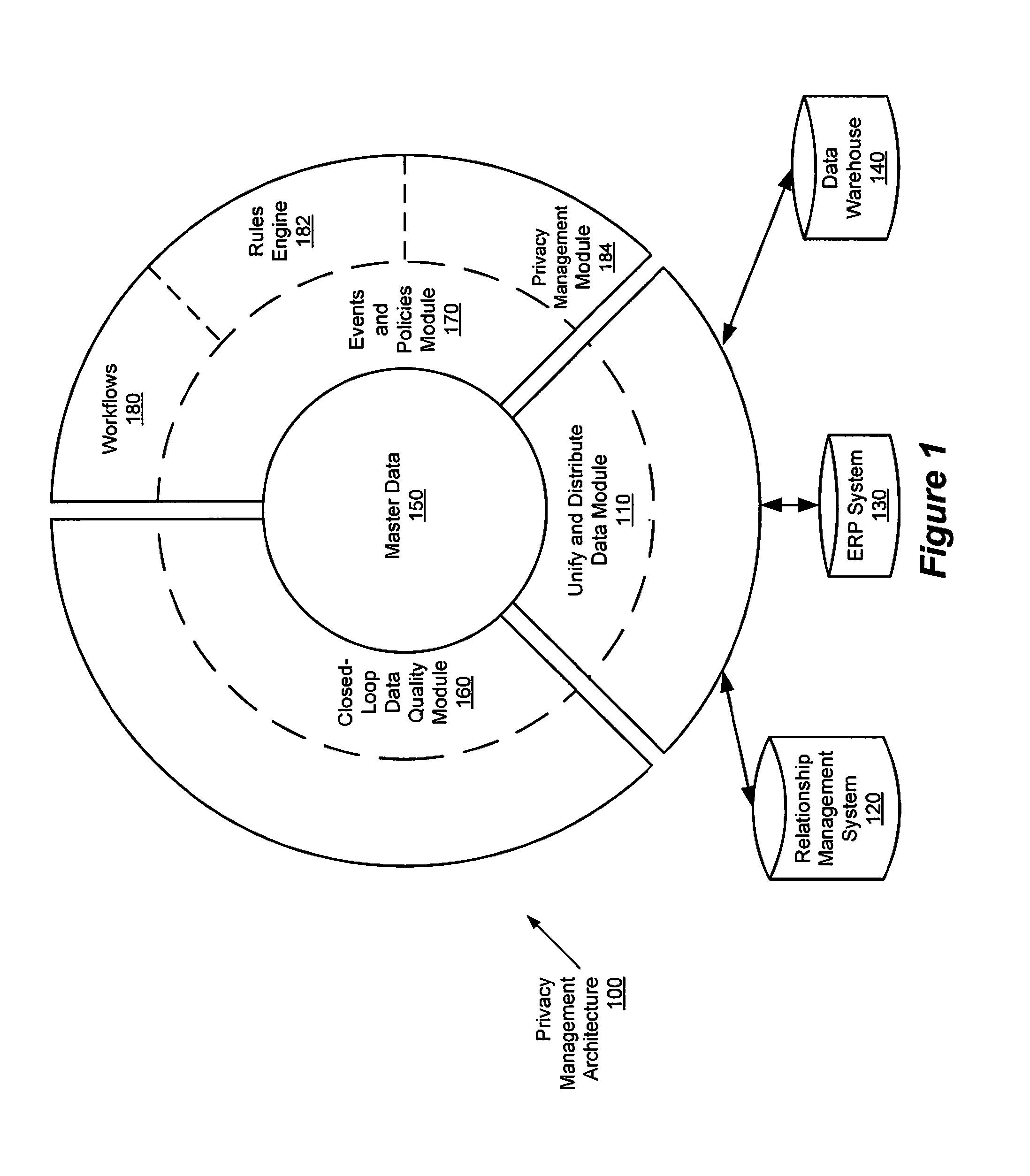

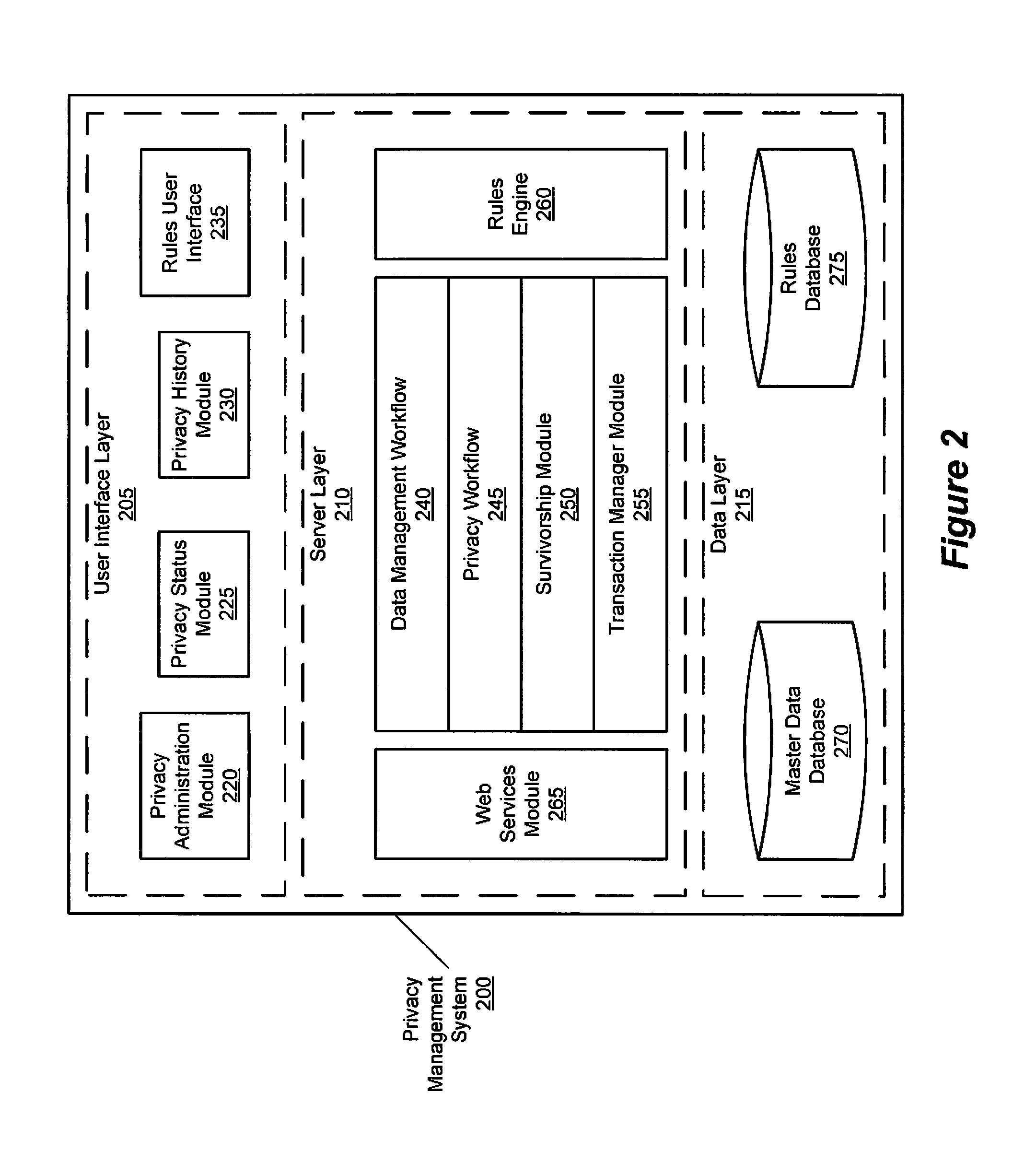

Privacy management policy hub

A system architecture is disclosed that includes a privacy management system. In particular, the privacy management system provides a policy hub for maintaining and managing customer privacy information. The privacy management system maintains a master data database for customer information and customer privacy preferences, and a rules database for privacy rules. The privacy management system captures, synchronizes, and stores customer privacy data. Privacy rules may be authored using a privacy management vocabulary, and can be customized for an enterprise's privacy policies.

Owner:ORACLE INT CORP

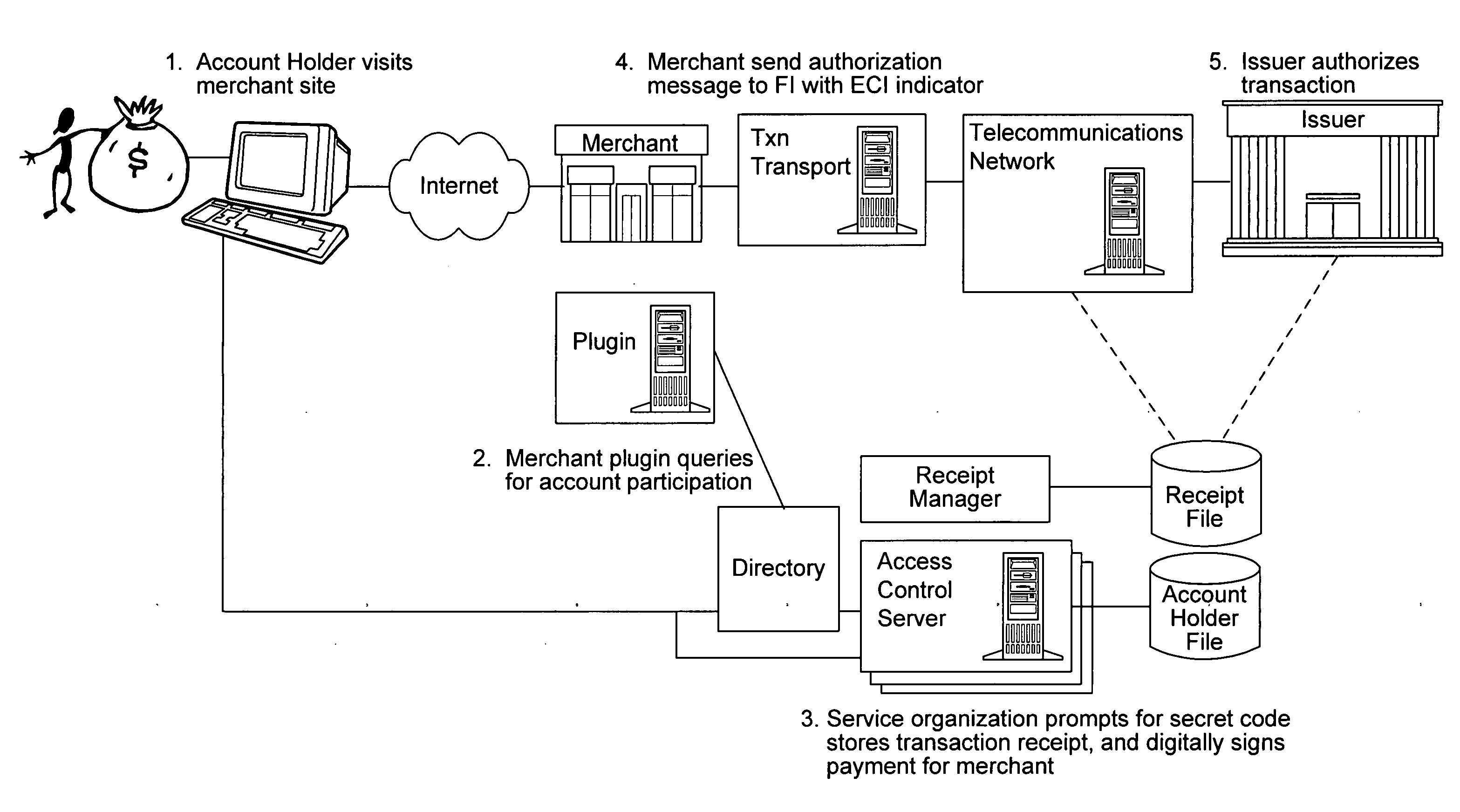

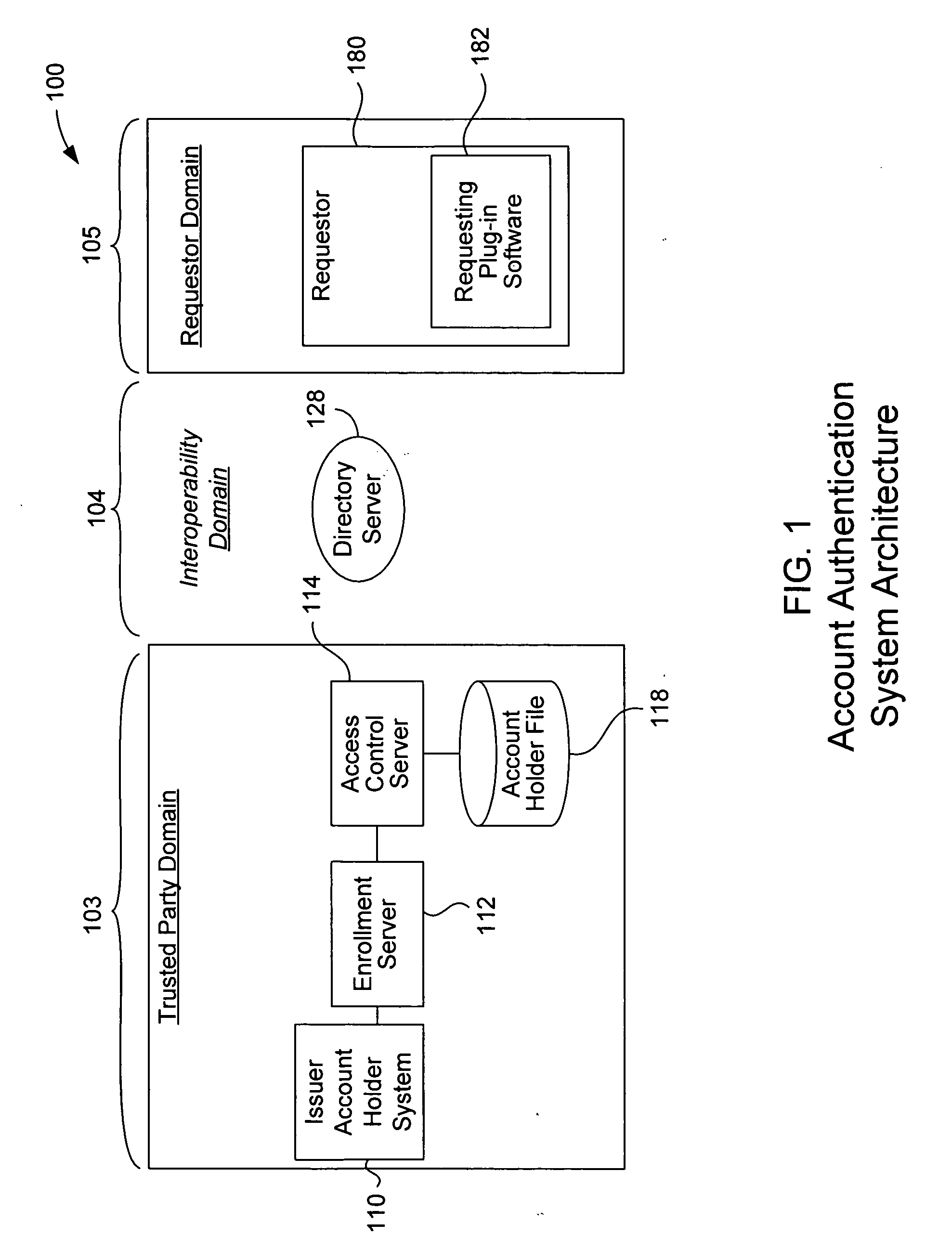

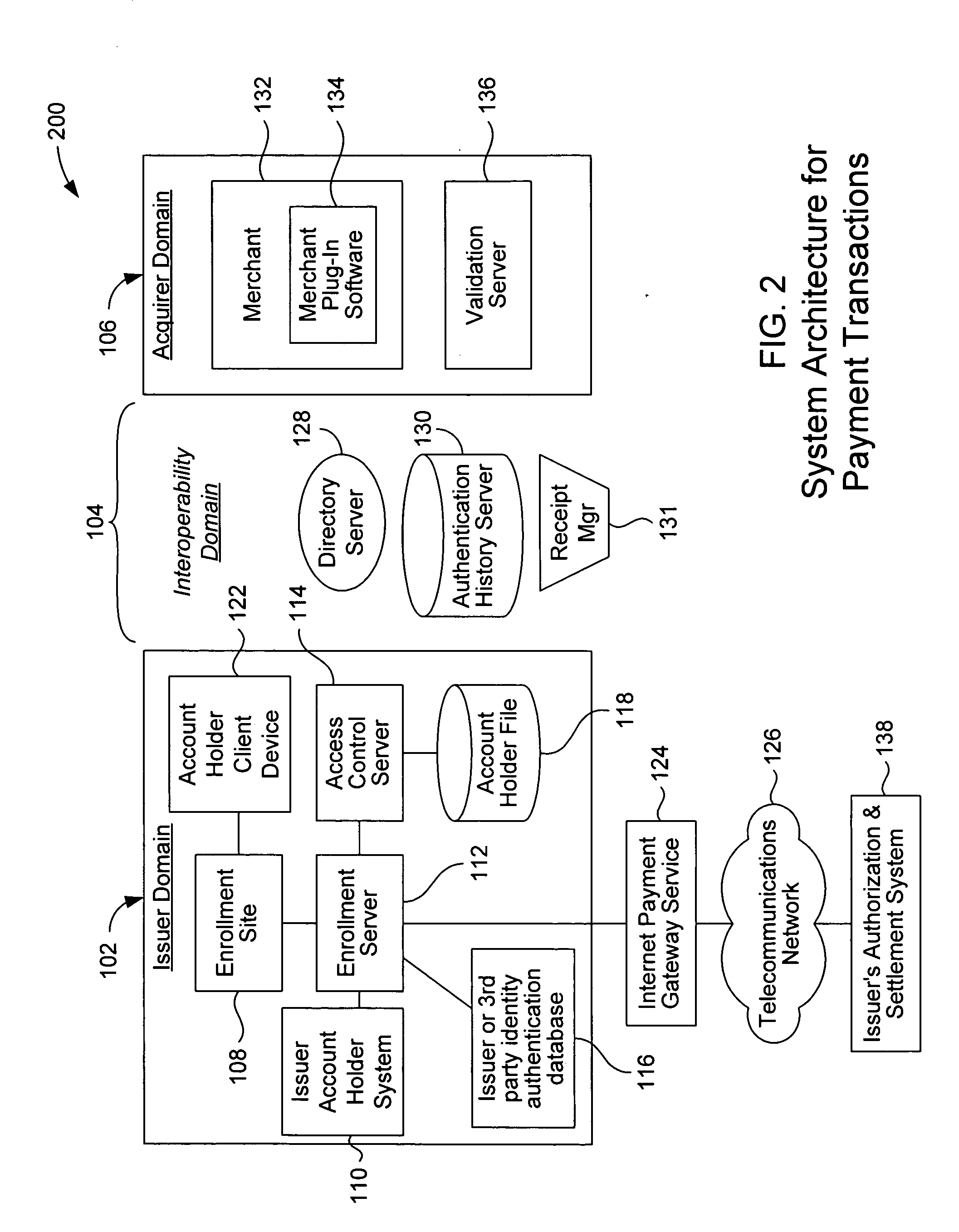

Multiple party benefit from an online authentication service

An account authentication service where a trusted party verifies an account holder's identity for the benefit of a requestor during an online transaction. The account authentication involves requesting a password from the account holder, verifying the password, and notifying the requestor whether the account holder's authenticity has been verified. An alternative embodiment of the account authentication service includes a value-adding component where information about a customer is shared with a value-adding party. The customer information is rich in detail about the customer since it is collected by each of the parties in the account authentication process. The value-adding party can then use this information in various manners. All of the parties involved can benefit from sharing the customer information. The value-adding party can be, for example, a merchant, a shipper, a security organization, or a governmental organization. A transaction identifier identifies a specific transaction between a customer, a merchant, and the customer information.

Owner:VISA INT SERVICE ASSOC

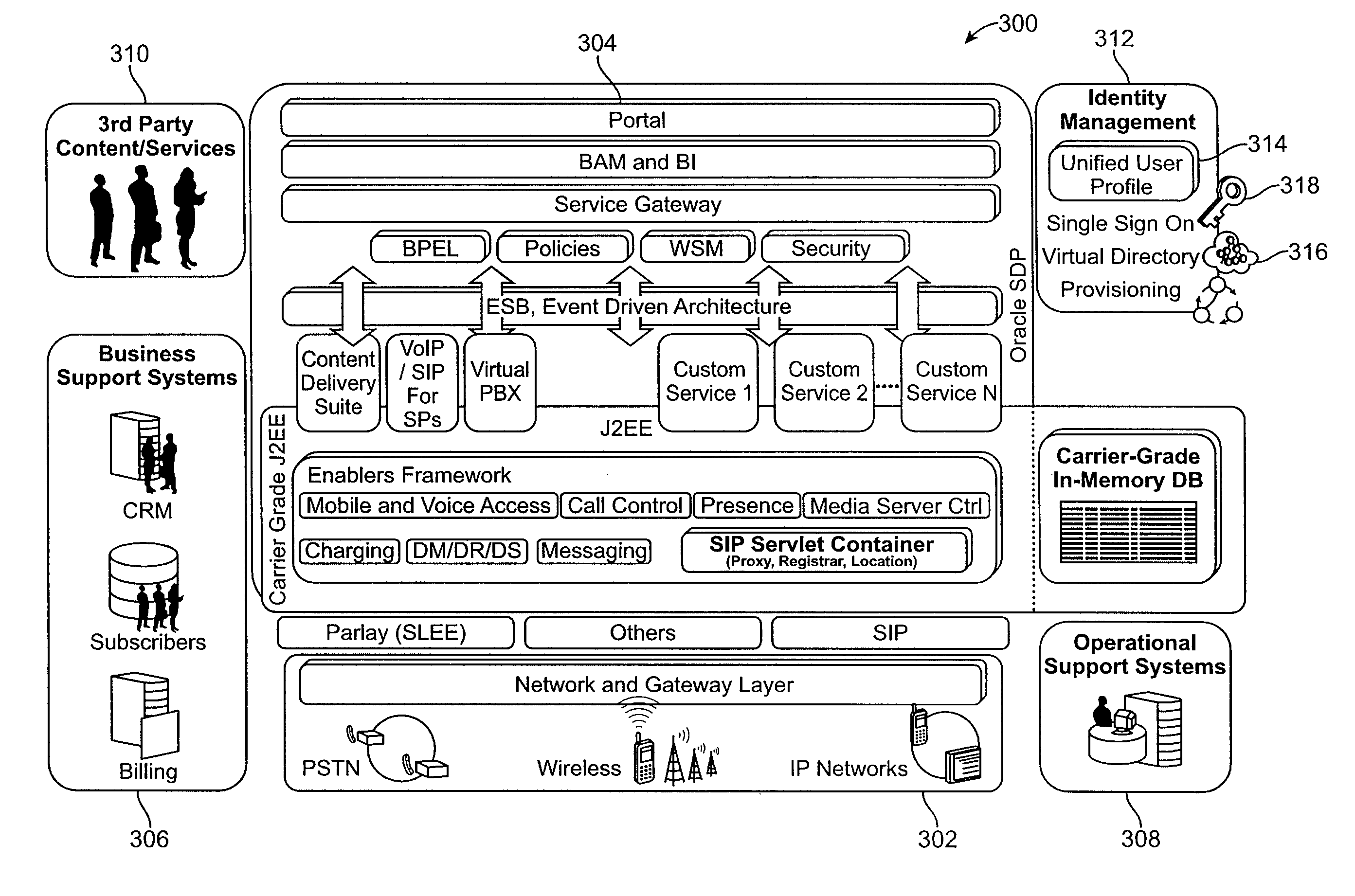

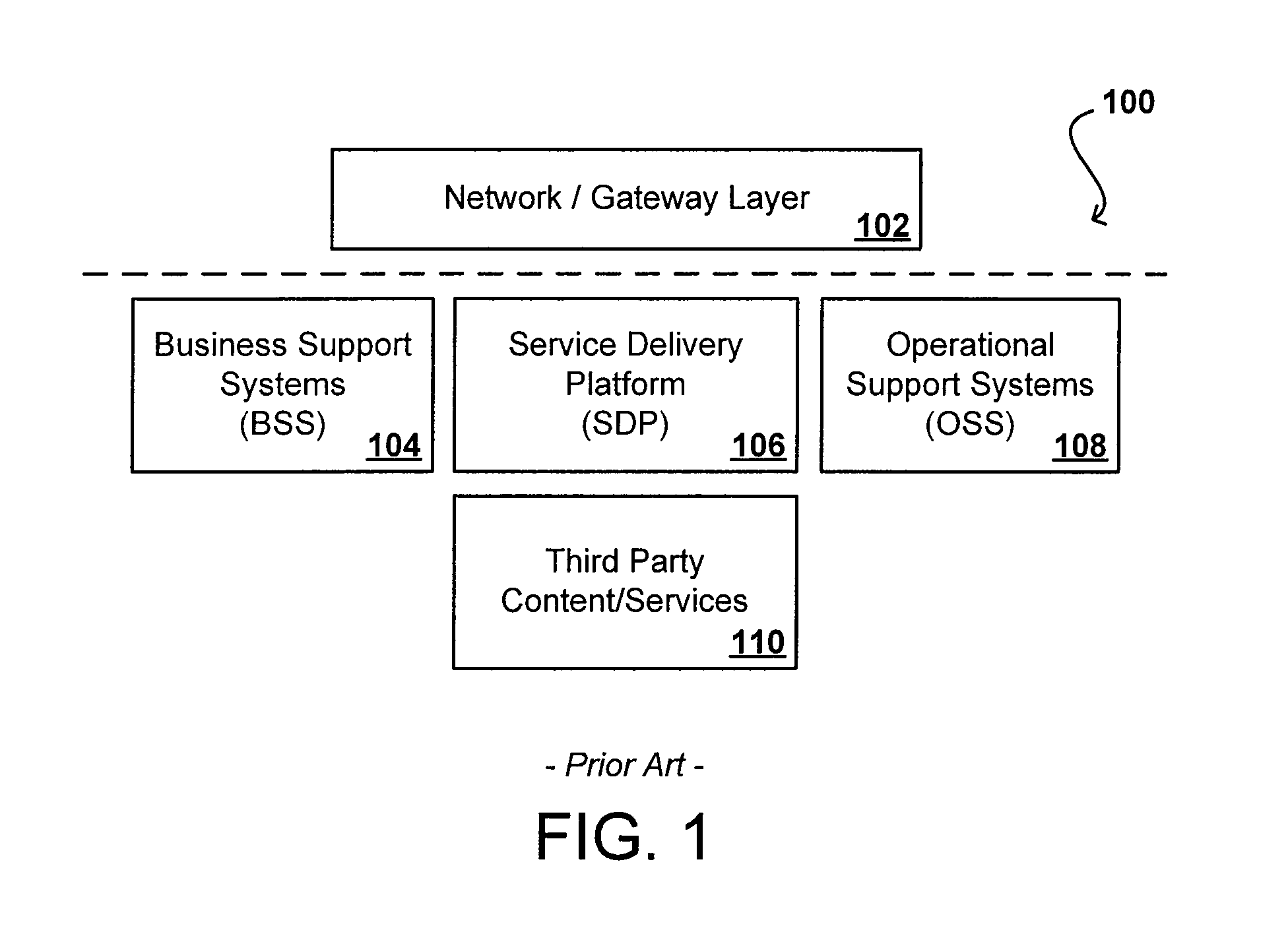

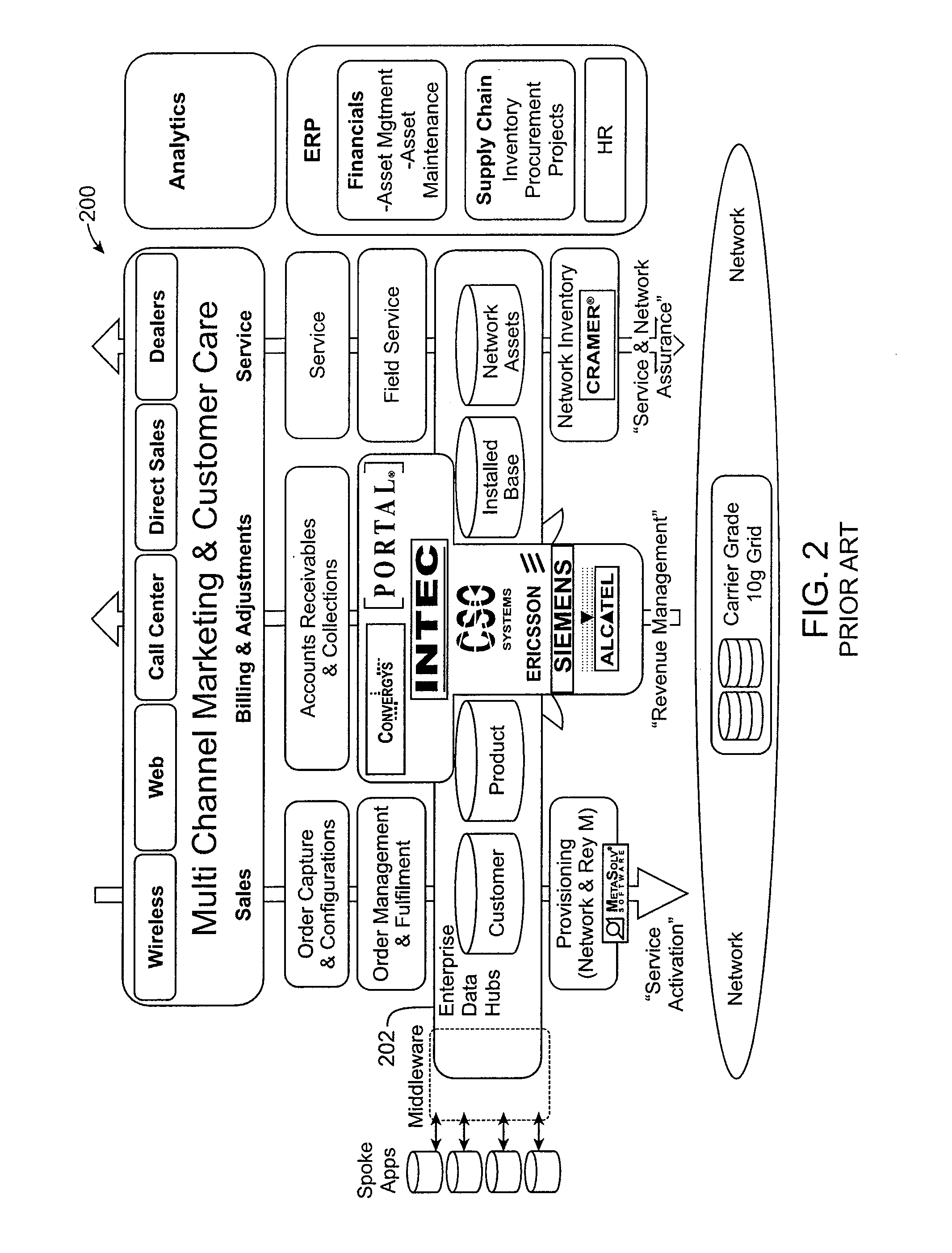

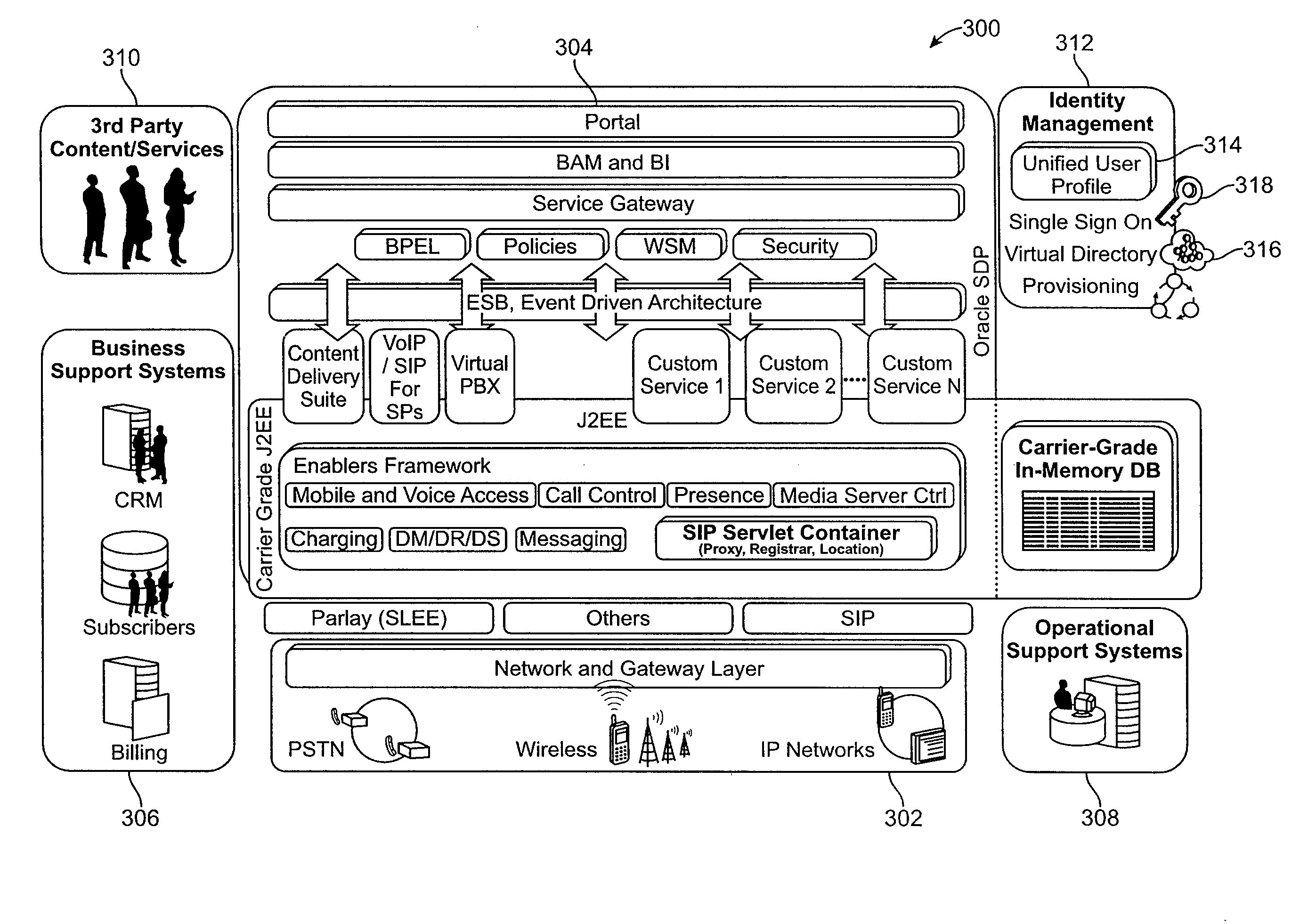

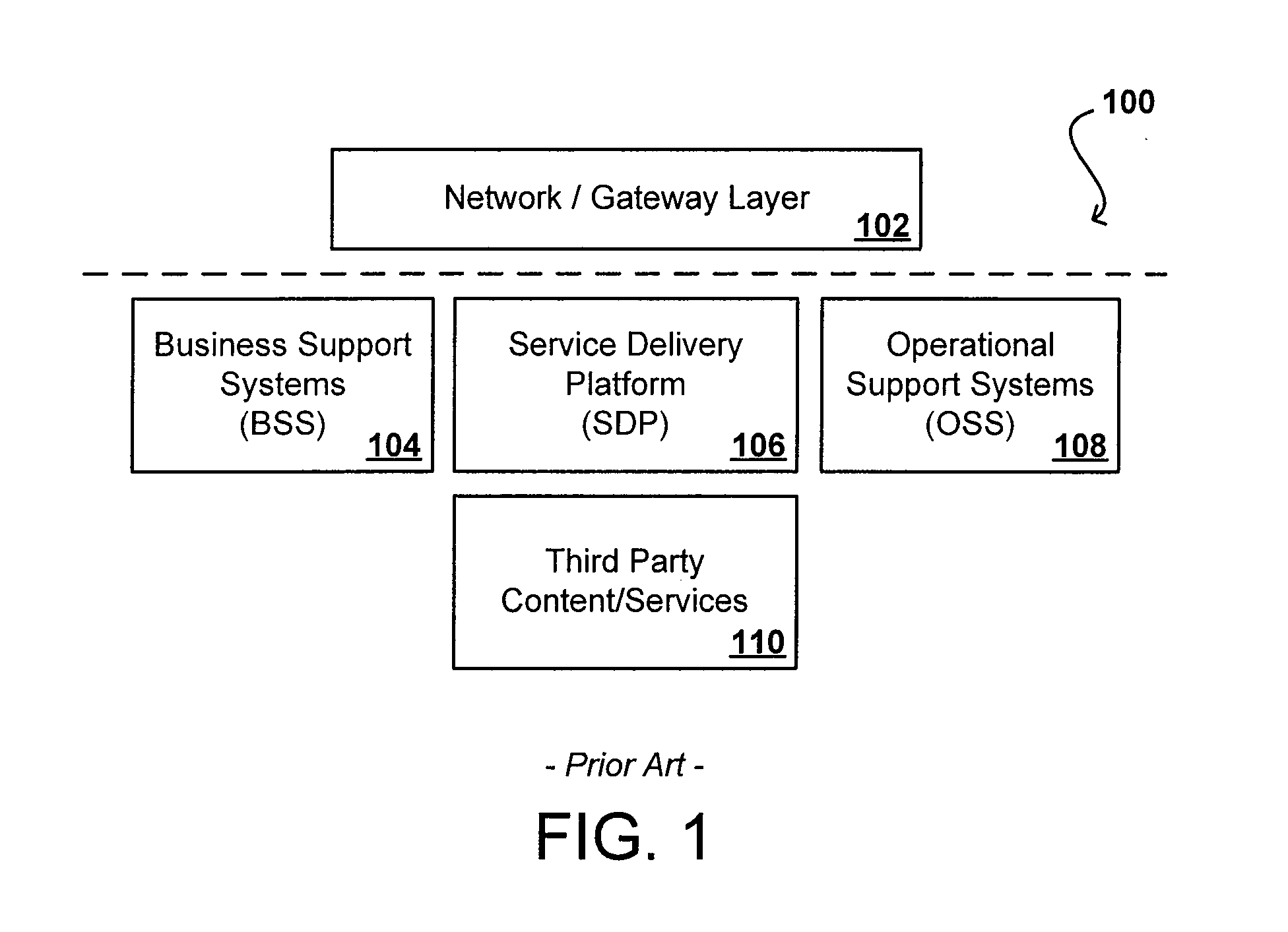

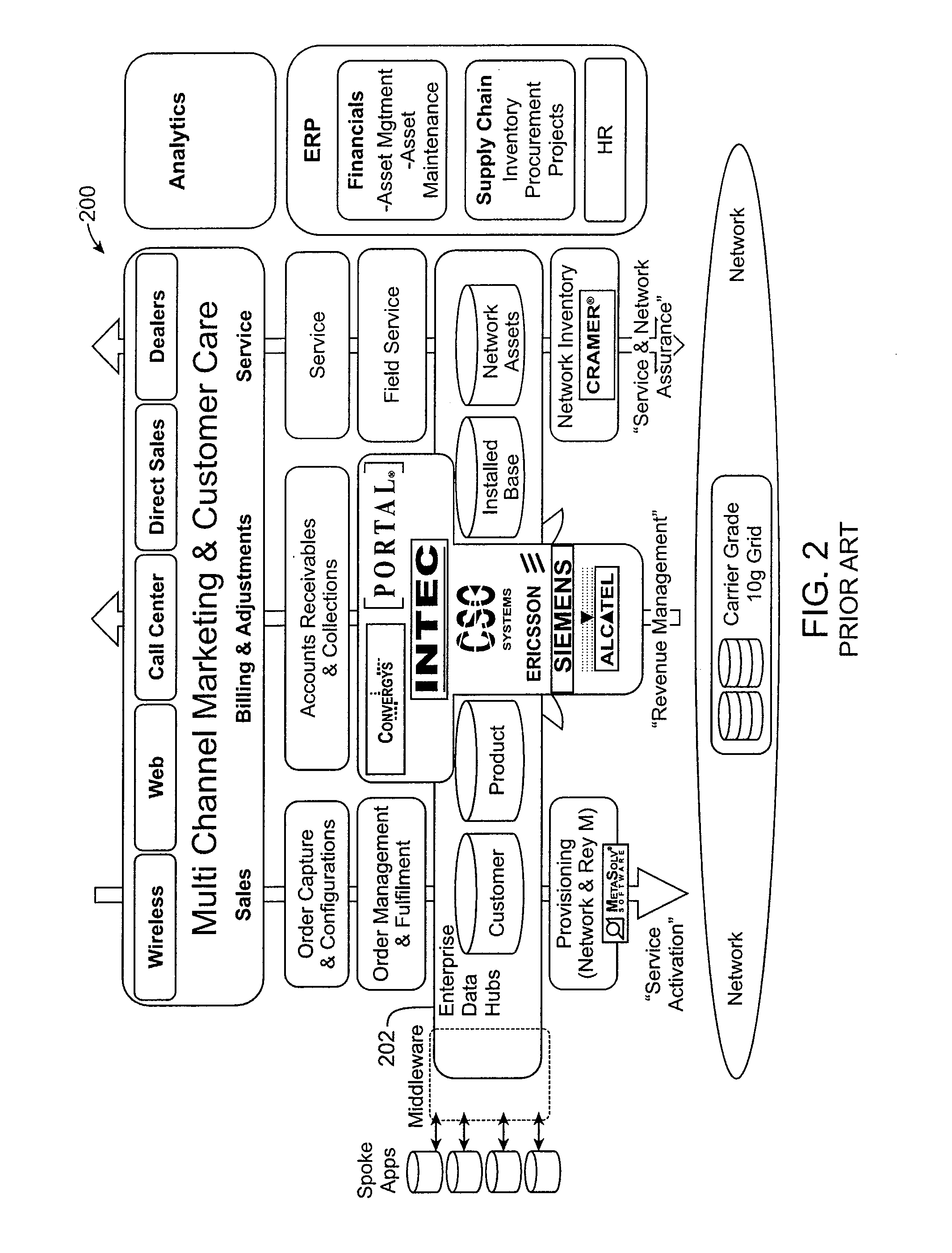

Shared view of customers across business support systems (BSS) and a service delivery platform (SDP)

ActiveUS8073810B2Overcome deficienciesDigital data processing detailsDatabase distribution/replicationData aggregatorCustomer information

Owner:ORACLE INT CORP

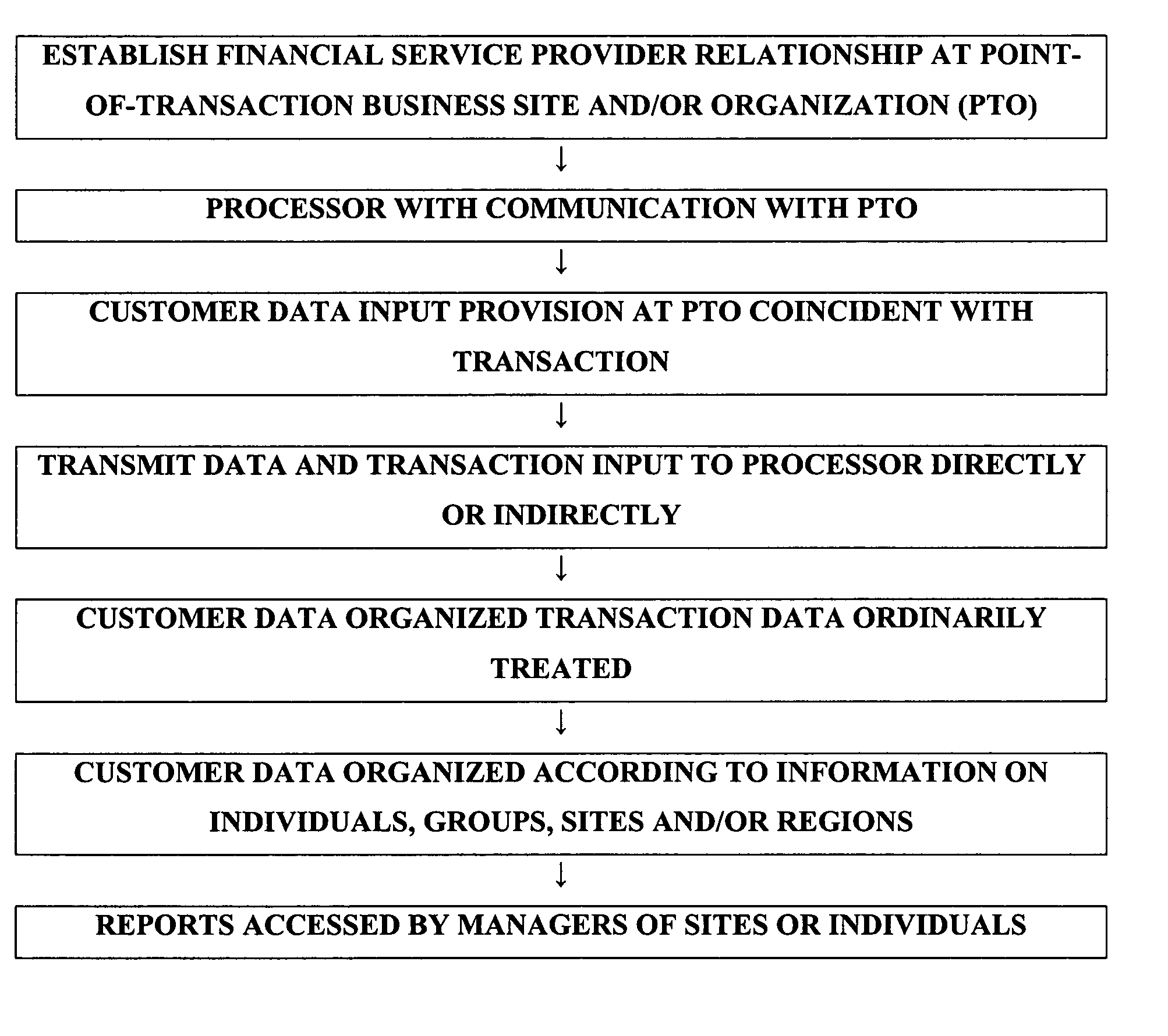

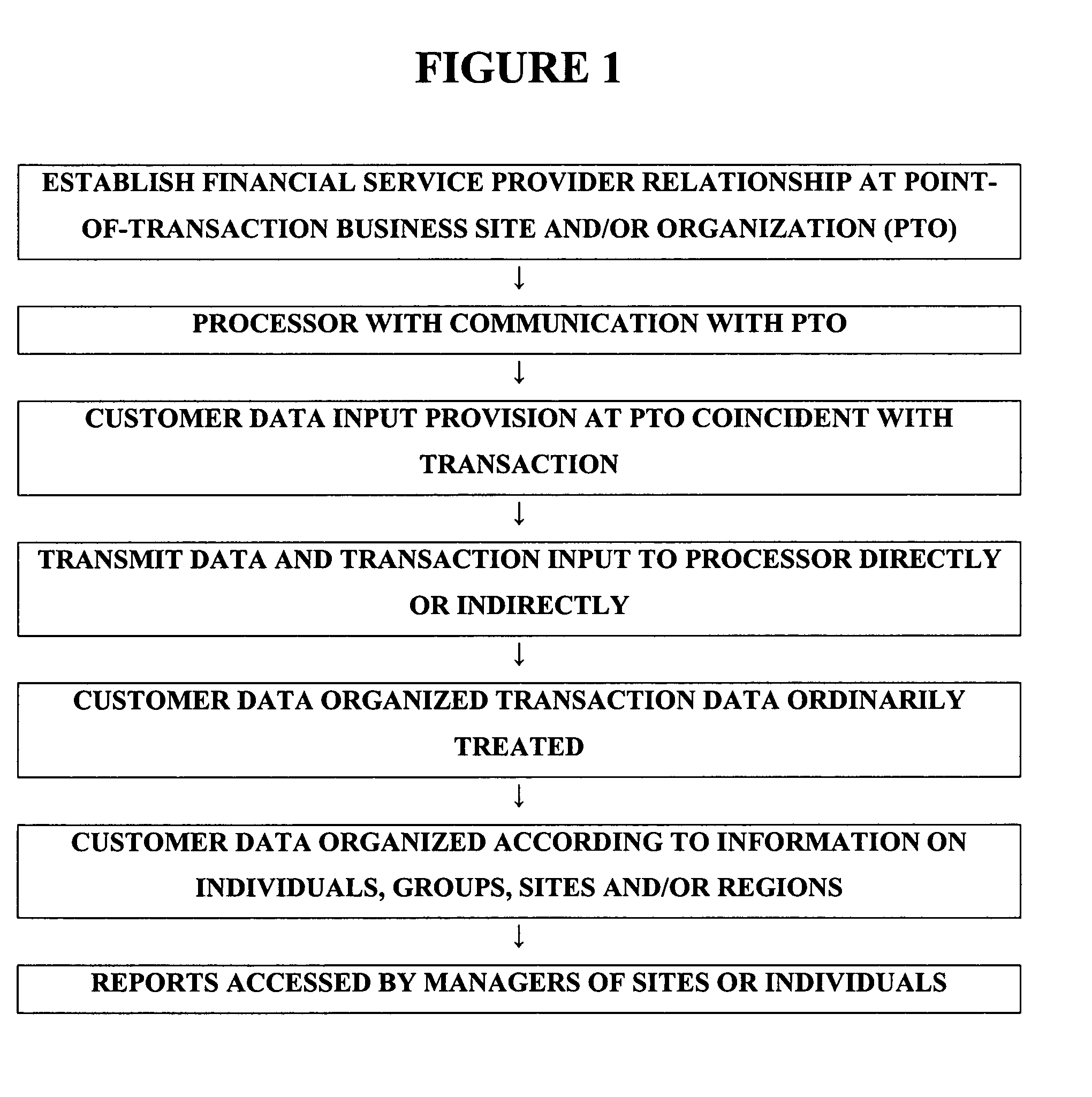

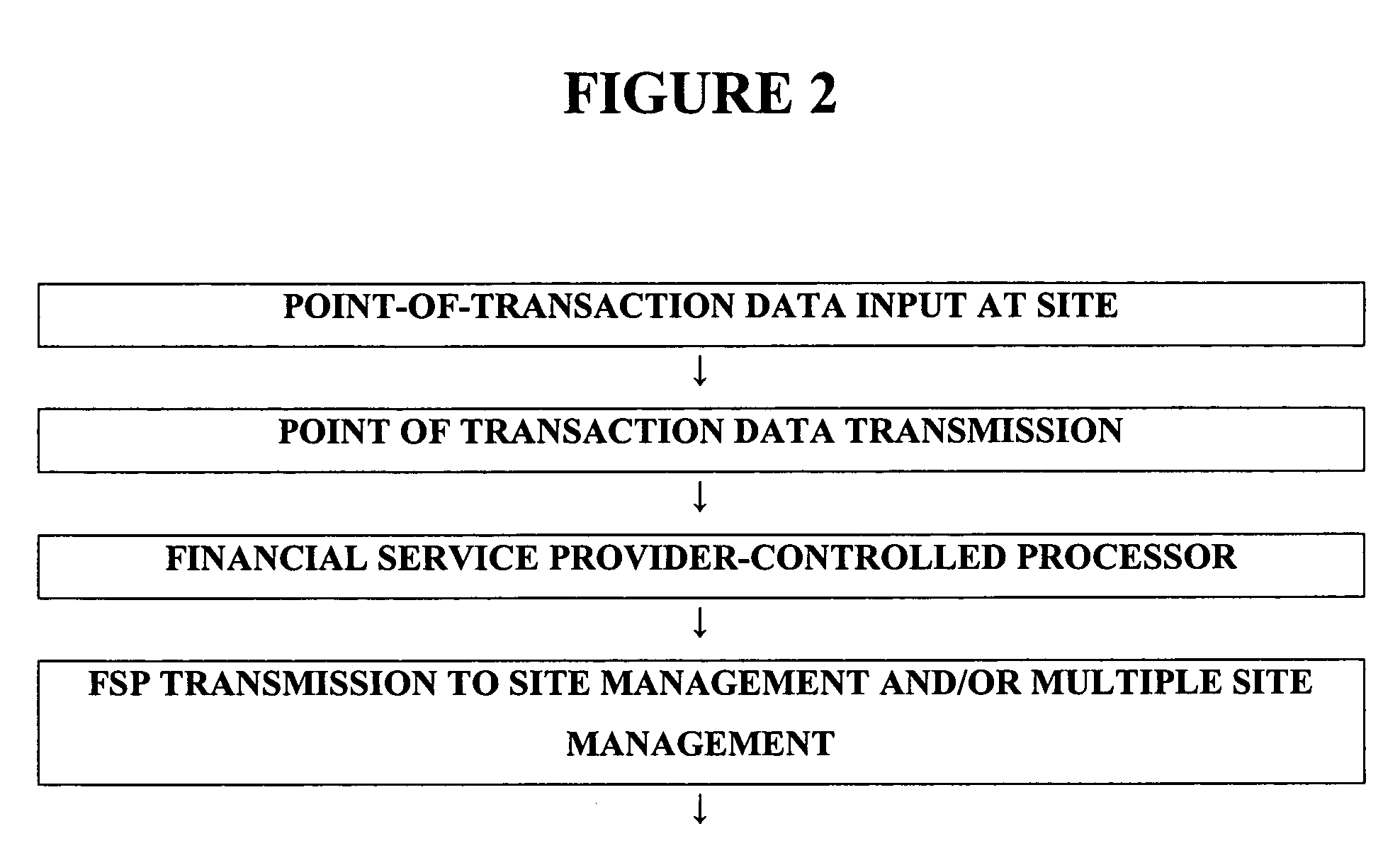

Point-of-sale provider evaluation

A system provides information indicative of customer satisfaction respecting at least one service or sales provider, the system including at least one customer information entry component that provides customer input to a database supported by a financial service provider that assists point-of-sales or point-of-service payment to a site. The system can segregate or aggregate accumulated customer input data according to at least business one customer of the financial service provider. At least one business customer can access information from the accumulated customer input data that relates to data relating to that specific business customer. The system can provide alerts and / or can relate the data in its variance to the customer's historical average scores. A method of providing information to a master business site regarding a subordinate business site comprises providing the subordinate business site with a point-of-sales or point-of-service data input for local customer site evaluation data to be provided by a local on-site primary customer, data input and data reception being directly associated with a financial service provider electronically supported economic transactions and transmitting data relating to both the economic service and the local customer site evaluation data to a processor that receives both the economic transaction data and the local customer site evaluation data.

Owner:FOSS SWIM SCHOOL LLC

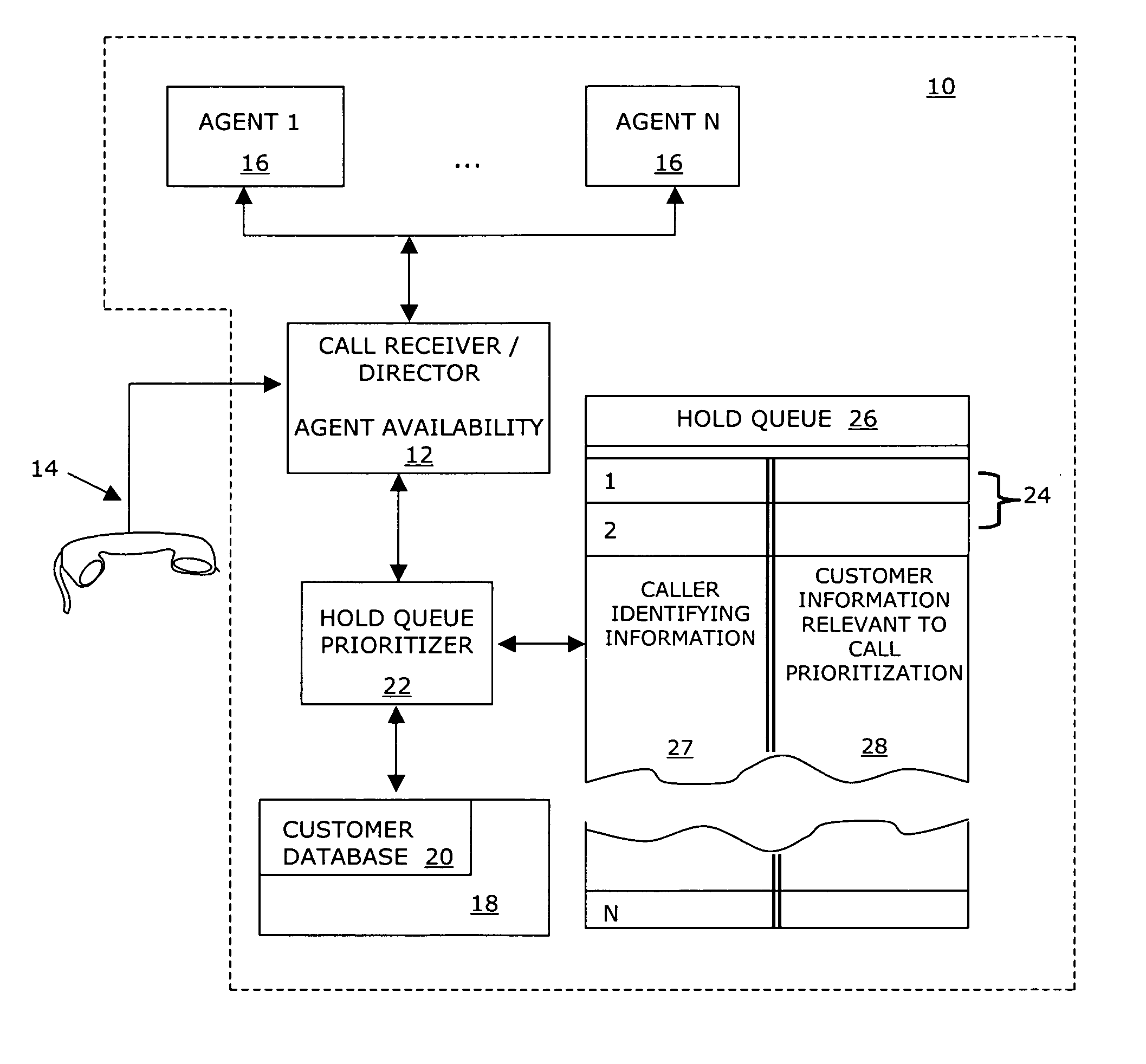

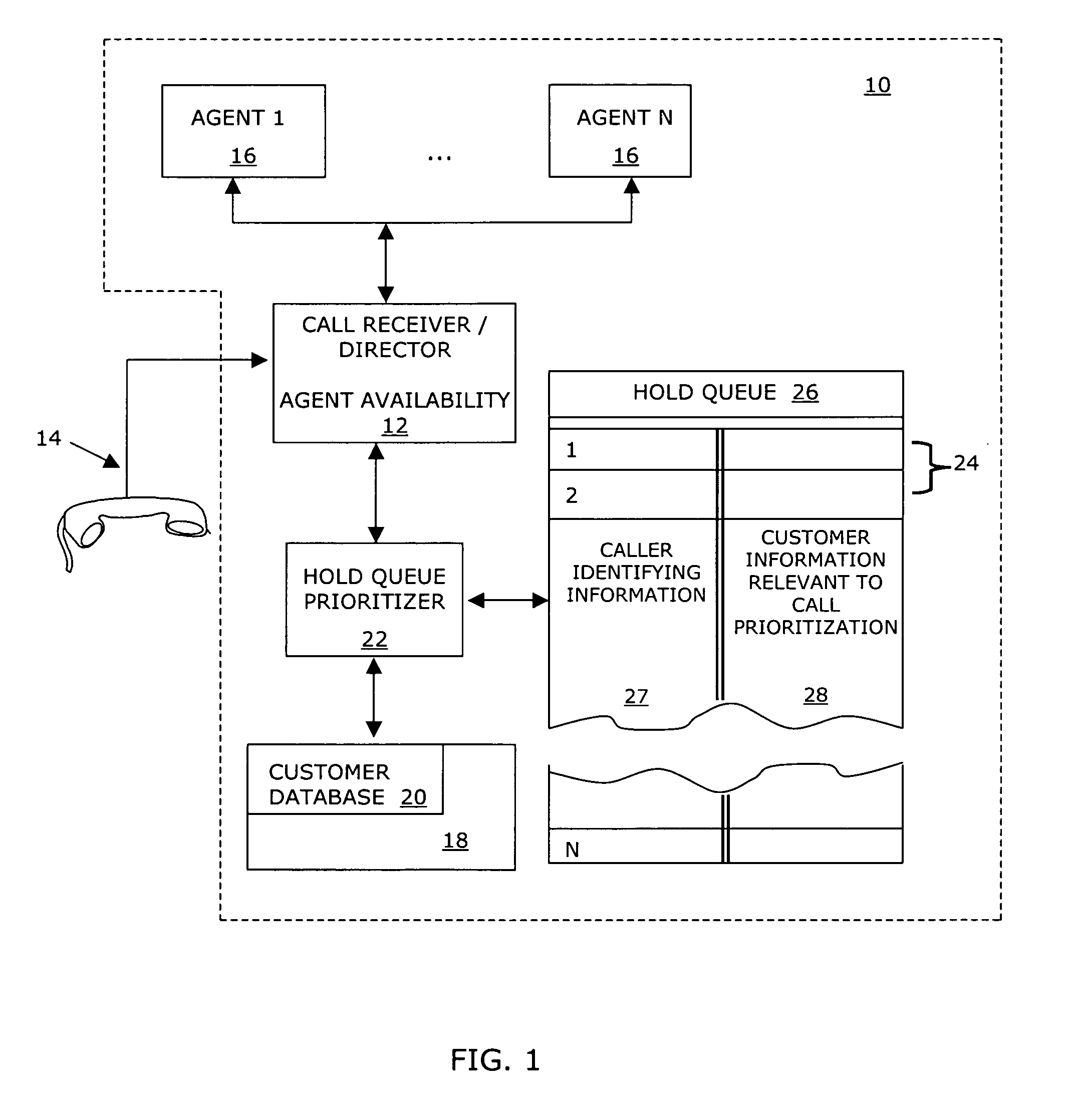

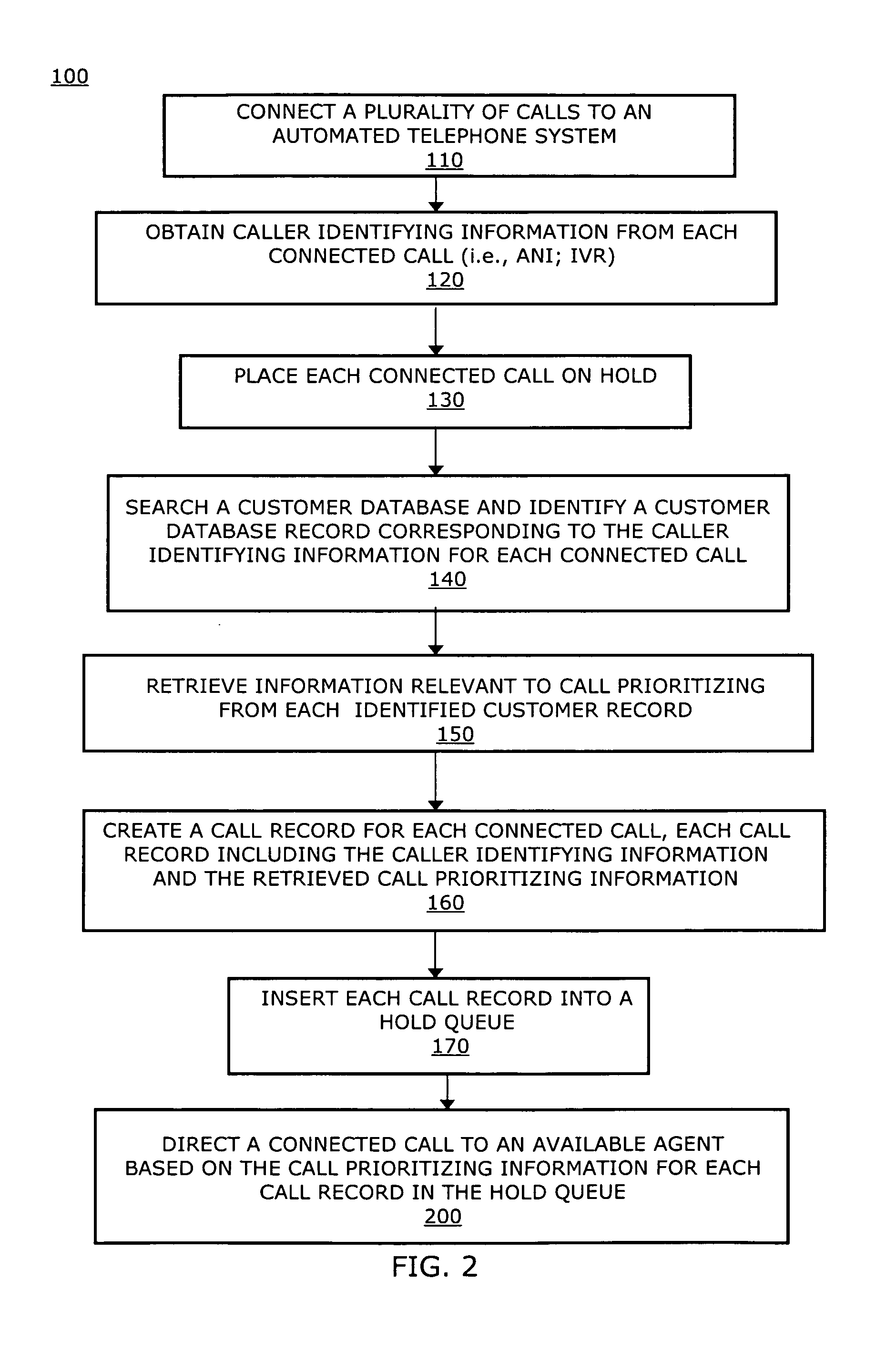

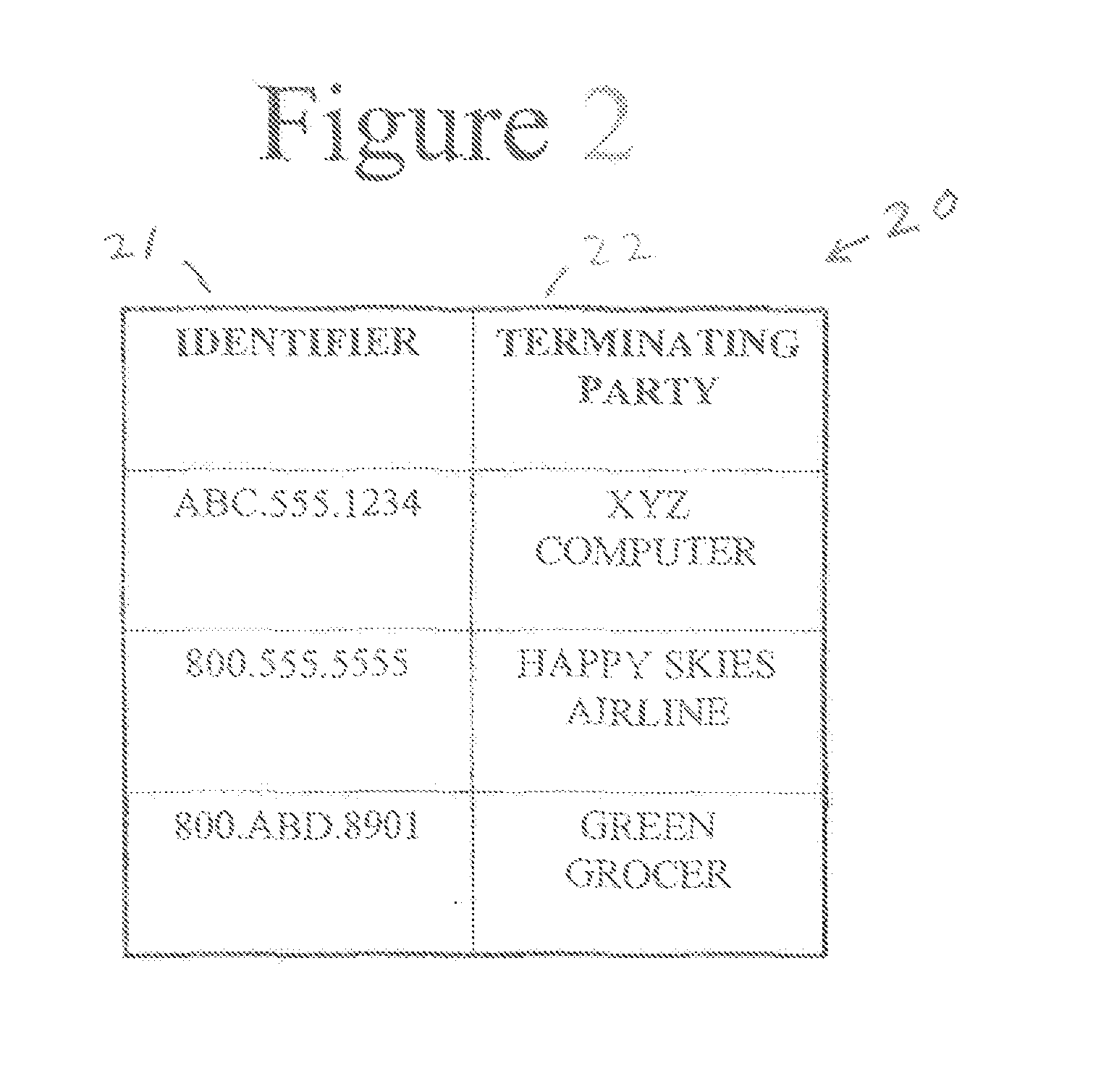

System and method for managing a hold queue based on customer information retrieved from a customer database

InactiveUS7068775B1Multiplex system selection arrangementsData switching by path configurationCustomer informationDatabase retrieval

A system, including a method for prioritizing on hold calls connected to an automated telephone system is disclosed. The system and method utilizes customer information retrieved from a customer database as call prioritizing information for each connected call. The method begins by connecting a plurality of calls to the automated telephone system. Caller identifying information is obtained from each connected call and each connected call is placed on hold. Then, a customer database is searched and a customer database record is identified corresponding the obtained caller identifying information for each connected call. A call record for each connected call is created and inserted into the hold queue. Each call record includes the caller identifying information and call prioritizing information corresponding to the connected call. The connected calls are then directed to available agents based on the call prioritizing information stored in each call record in the hold queue.

Owner:WILMINGTON TRUST NAT ASSOC AS ADMINISTATIVE AGENT +1

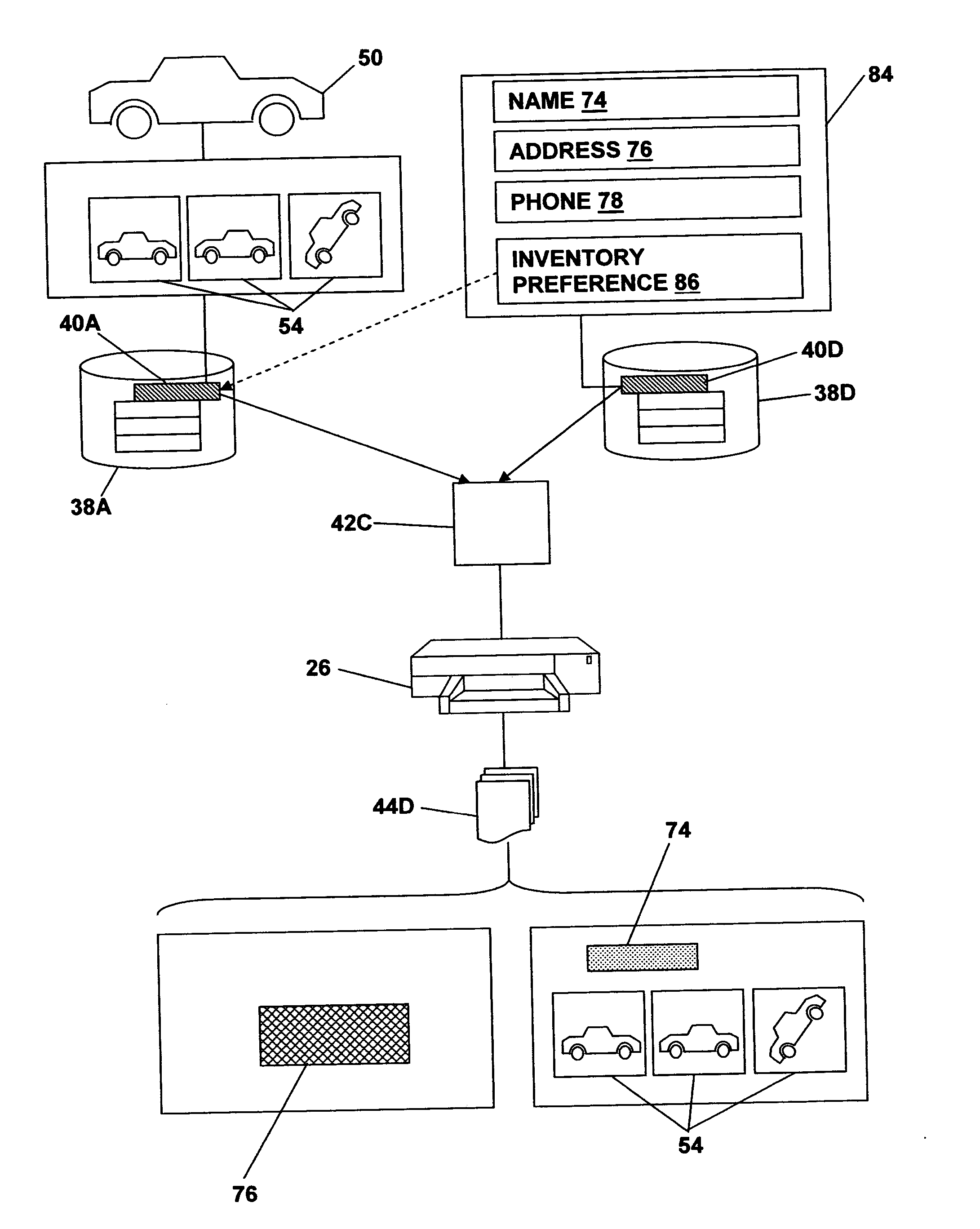

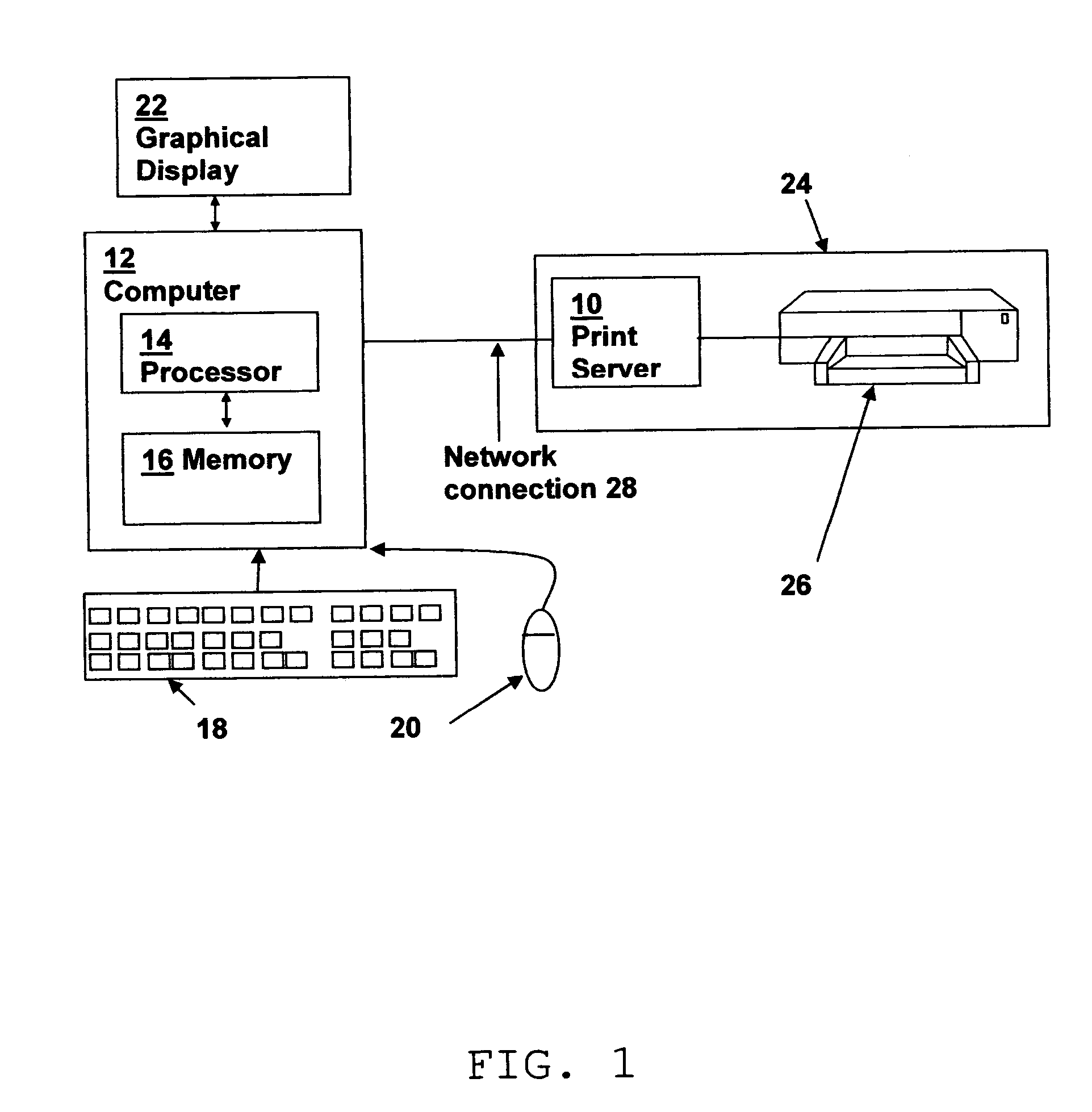

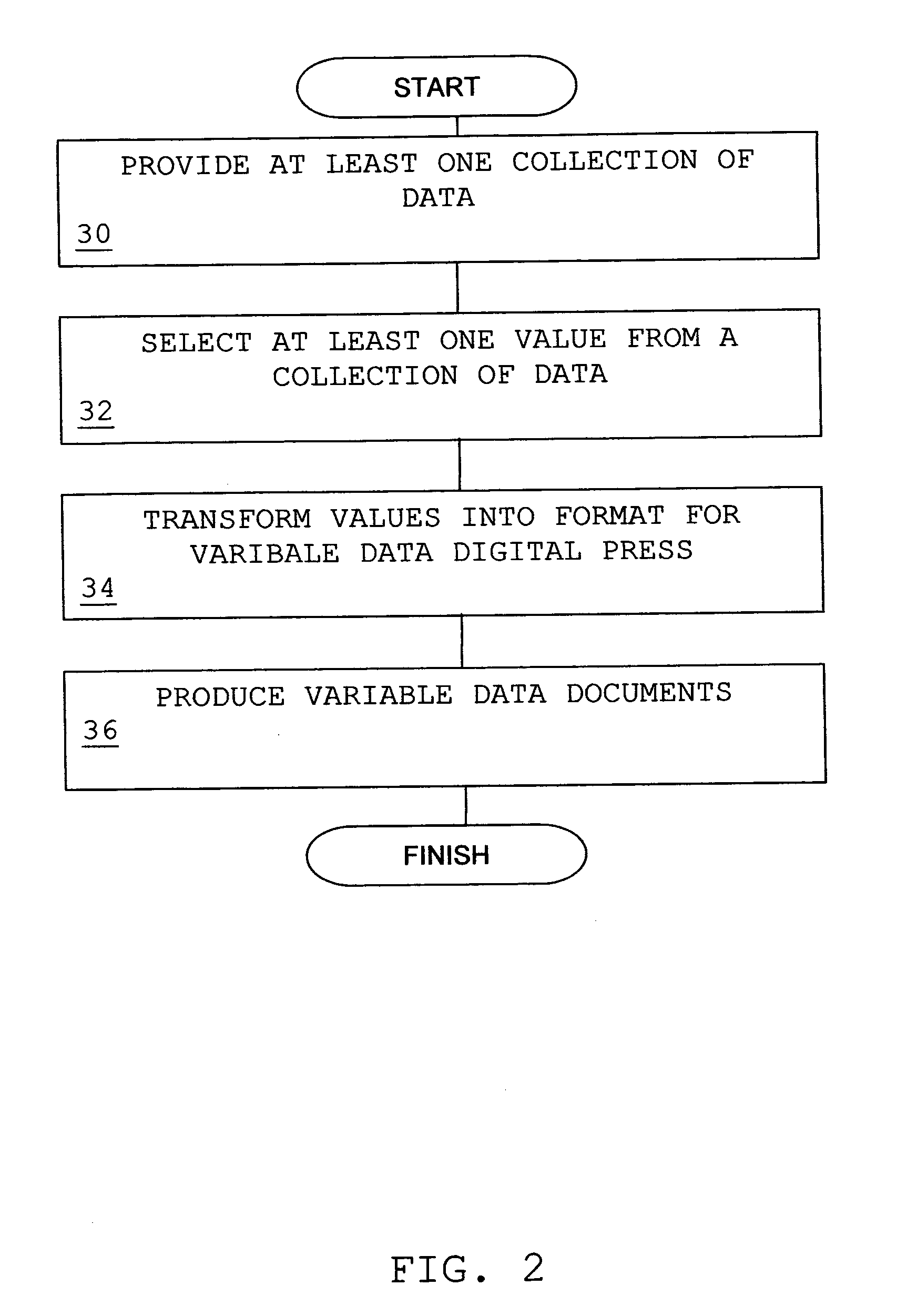

Variable data business system and method therefor

InactiveUS20060041443A1Visual presentationBuying/selling/leasing transactionsPersonalizationPaper document

A variable data business system and method provide improved production of documents in support of business operations. The system includes a server that stores business data and provides a network interface for access via a client browser. The system provides for entry, maintenance, and reporting functions of business data such mailing recipients, customer information, and business inventory. Interfaces are provided to access business data for the efficient design and production of personalized variable data documents. Themed promotional Internet websites are generated to complement themed promotional variable data document mailers. Automated electronic data gathering from third-party Internet information providers enhances the efficiency of business data collection and supports business transactions.

Owner:HORVATH CHARLES W JR

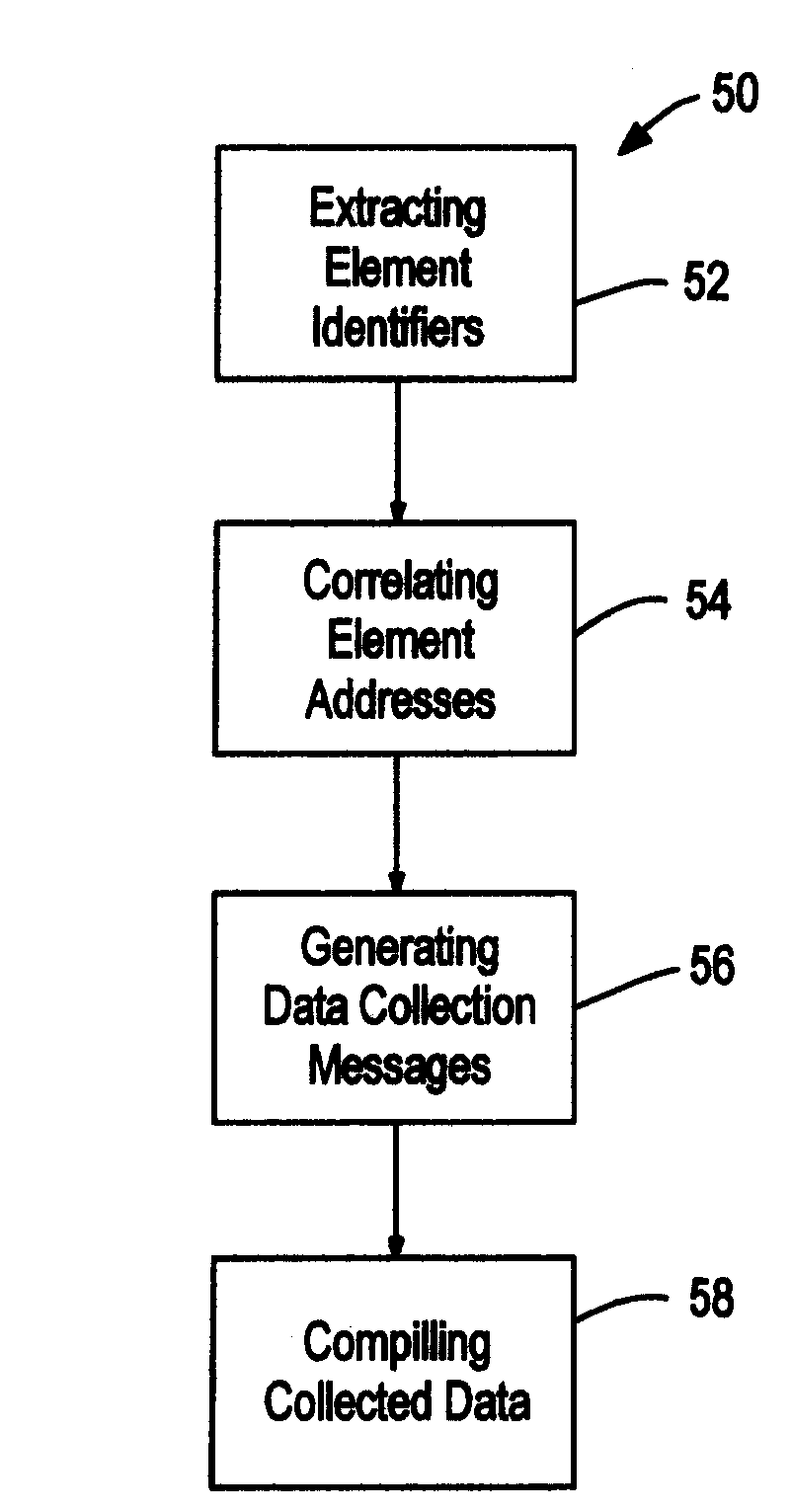

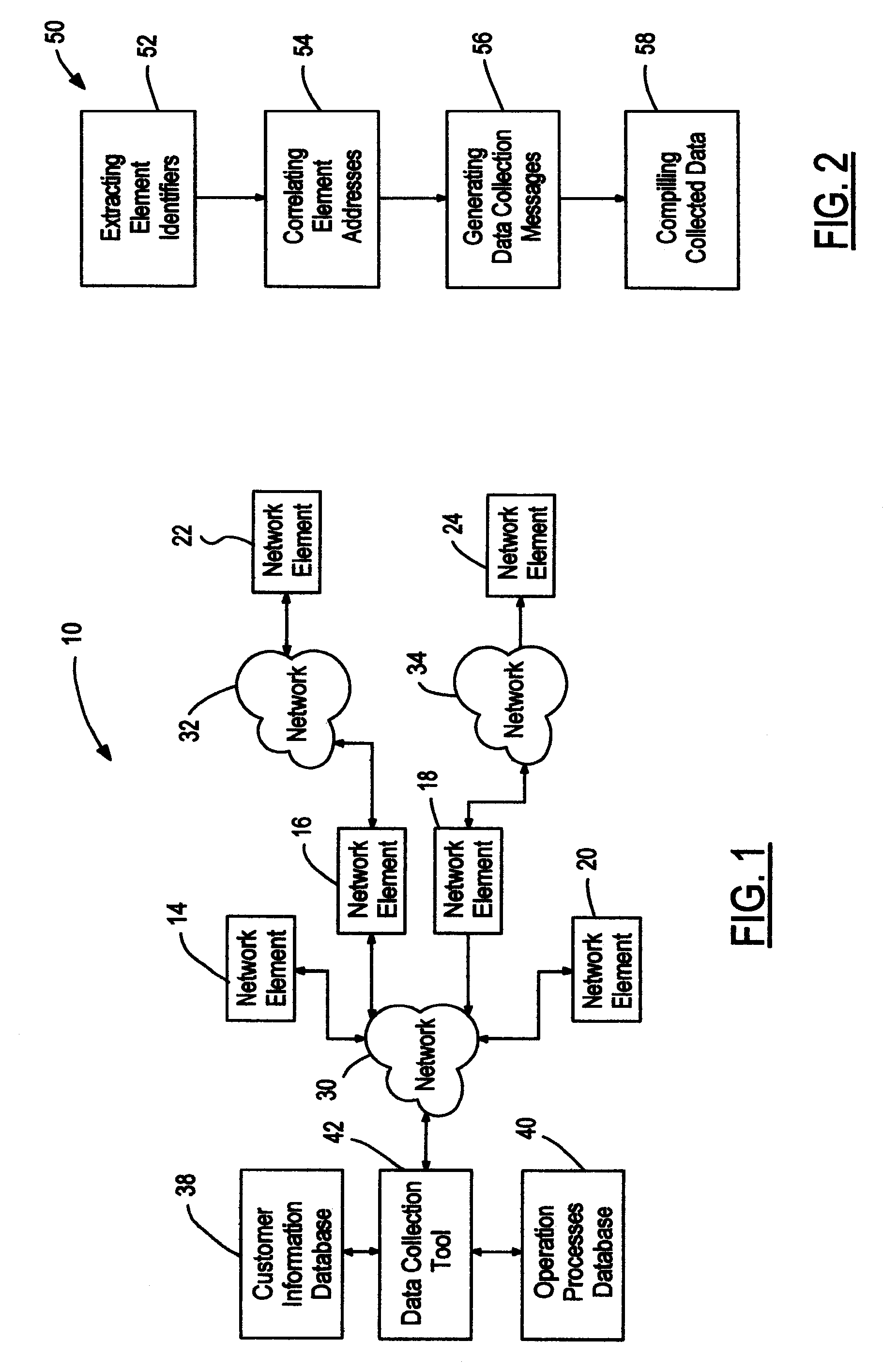

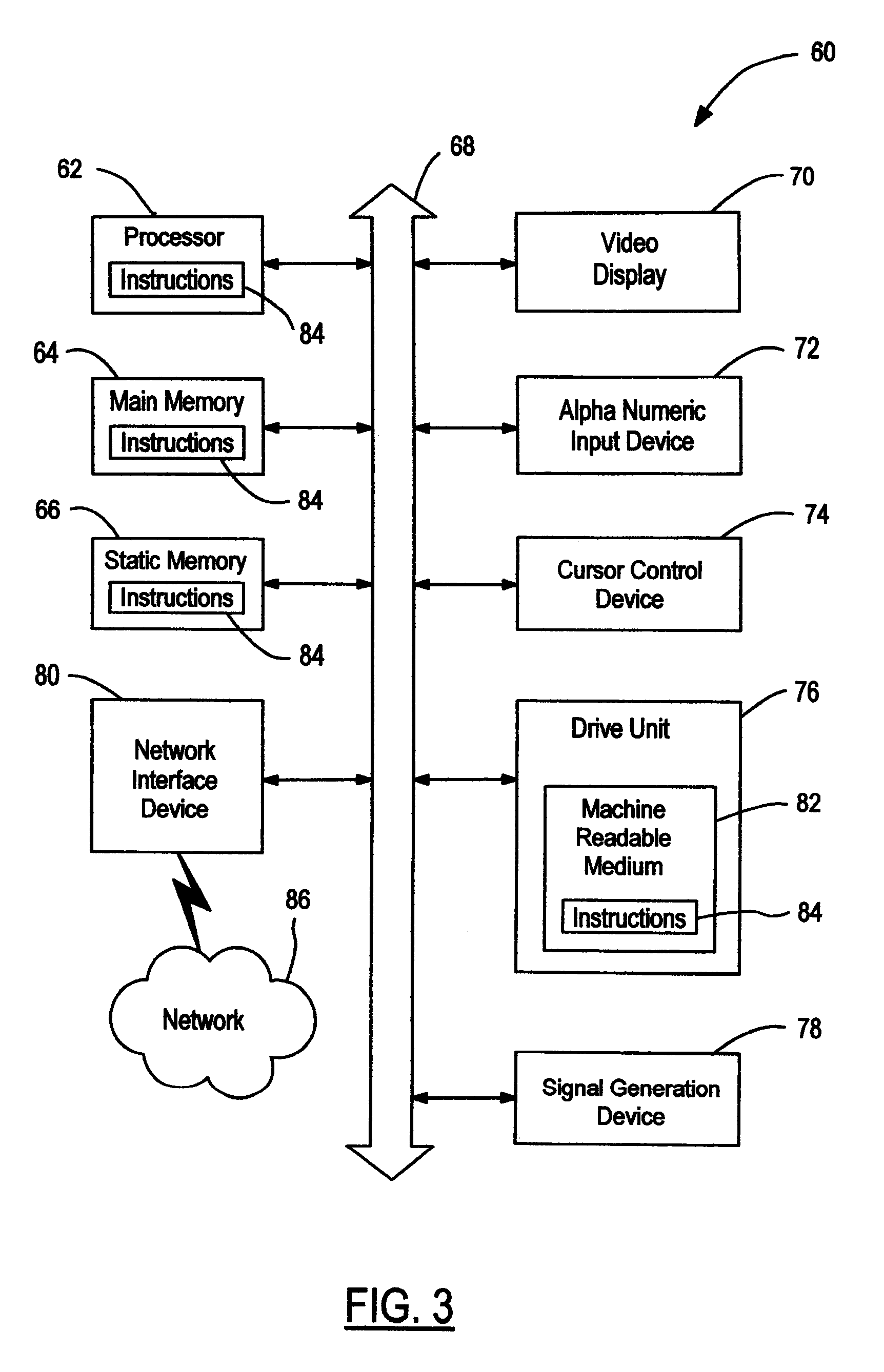

Method of collecting data from network elements

InactiveUS7472189B2Digital data processing detailsTelephonic communicationNetwork addressingNetwork address

Method of collecting data from one or more network elements used to support customer networks. The method may include compiling a customer list from information extracted from a customer information database and an operation processes database. The customer list may be used to indicate one or more customers, the network elements associated therewith, and network addresses for each of the listed network elements. The method may include automatically generating data collection messages to the network addresses specified in the customer list.

Owner:SBC KNOWLEDGE VENTURES LP

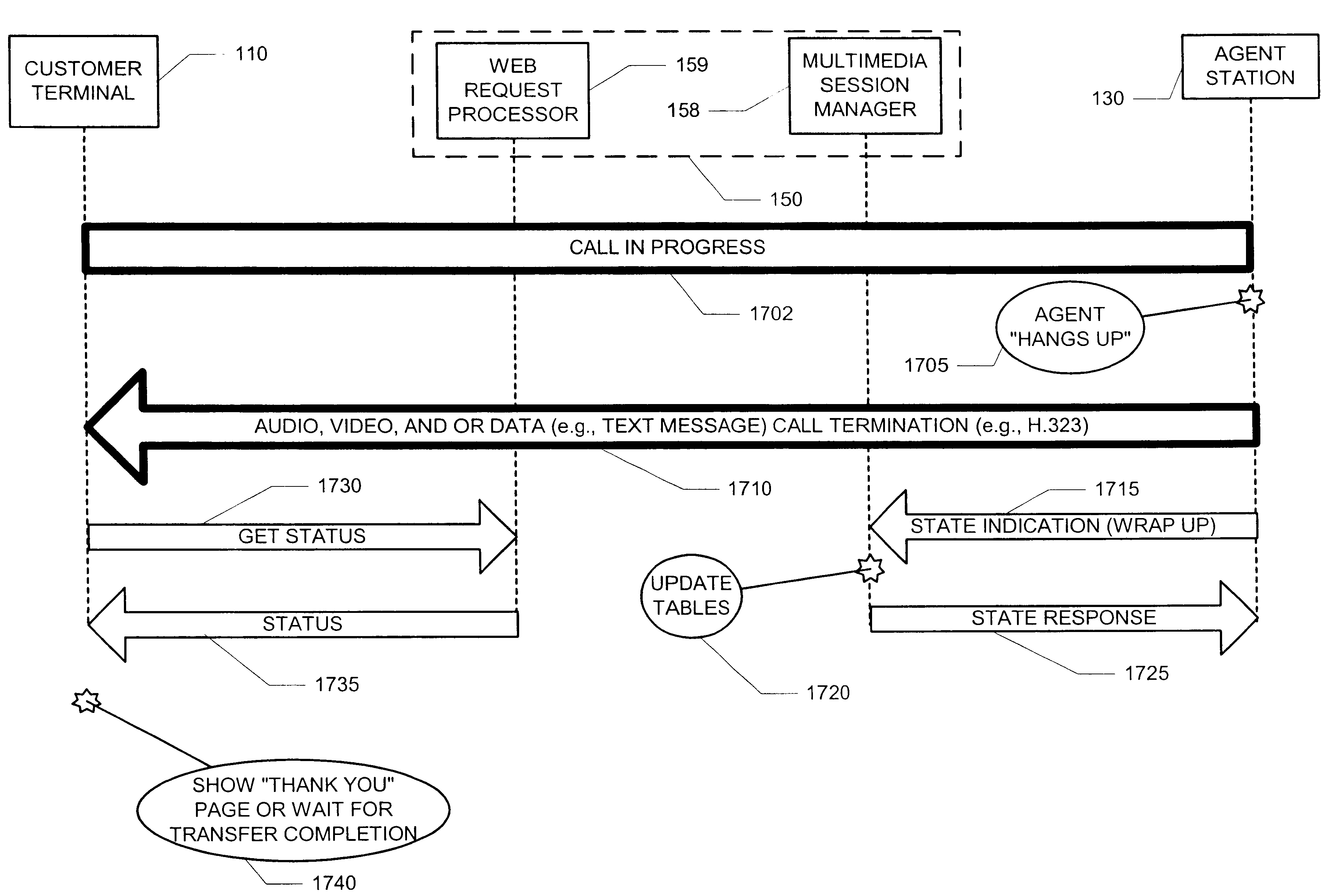

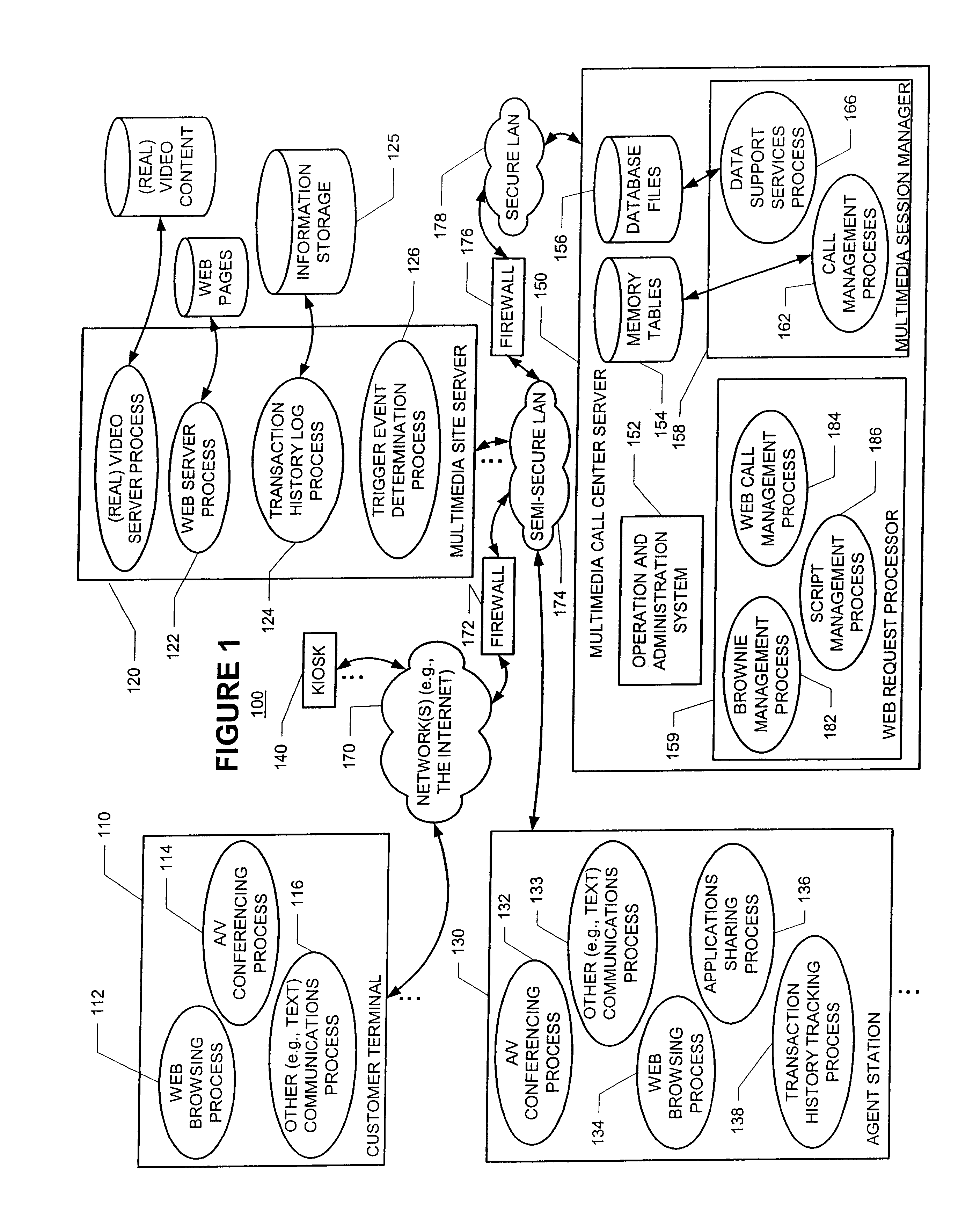

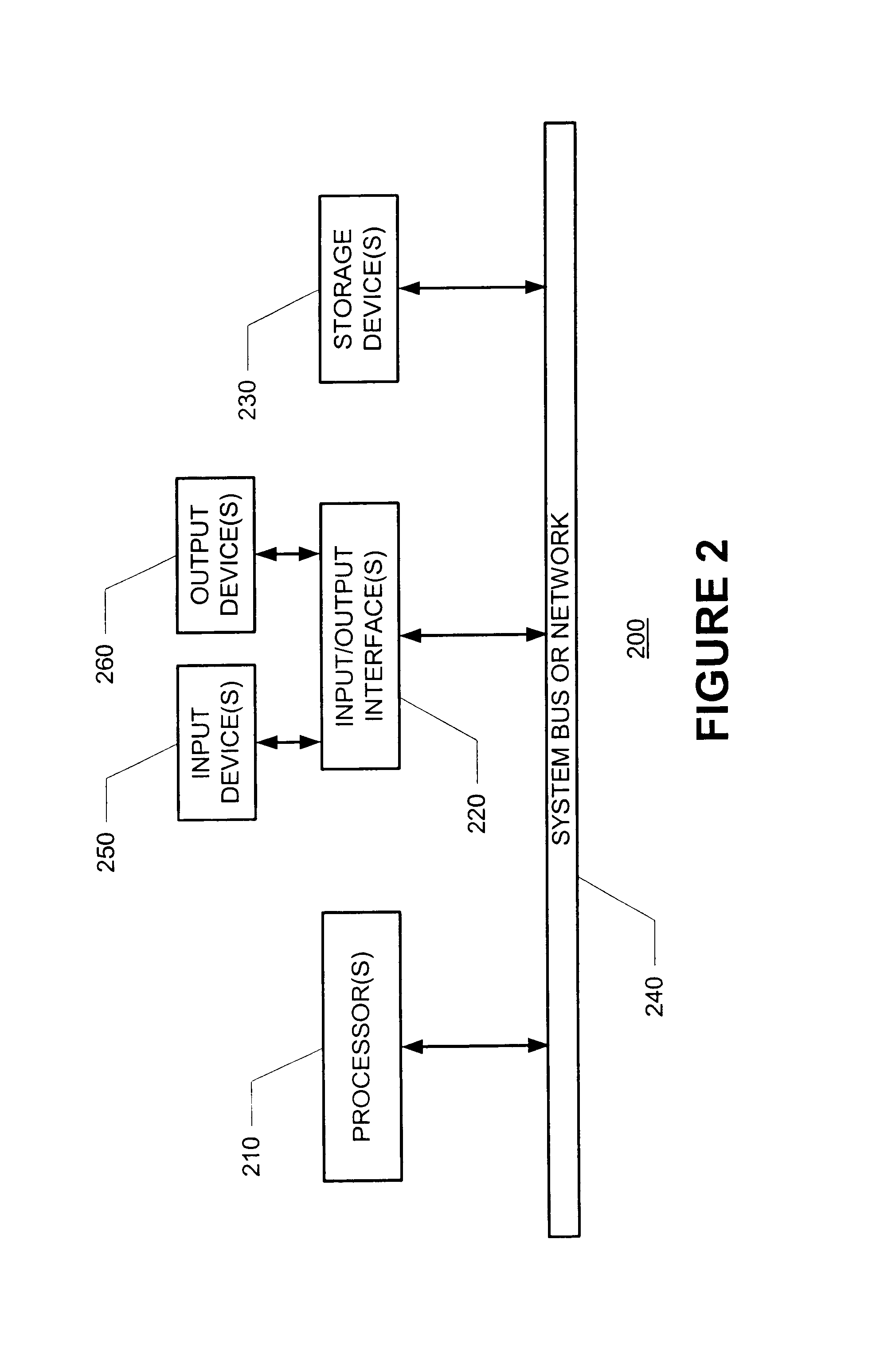

Methods and apparatus for providing live agent assistance

InactiveUS6771766B1Telephone data network interconnectionsAutomatic call-answering/message-recording/conversation-recordingSite agentWeb service

Establishing a conference between a customer at a customer terminal and a live agent at an agent station, by (a) accepting a call request from the customer terminal, (b) requesting that an available live agent take the call request, (c) when a live agent becomes available to take the call request, passing customer information to the agent station associated with the available live agent, and (d) establishing a conference from the agent station associated with the available live agent to the customer terminal. The conference may be an audio-video conference. The audio-video conference may be compliant with the H.323 standard. The call request may generated in response to an event sensed by an API which was previously downloaded to the customer terminal from a web server. The call request may be generated in response to a trigger event. The trigger event may be a customer request for a live agent, adding an item to a virtual shopping cart, adding items having a total purchase prices of more than a predetermined threshold to a virtual shopping cart, removing an item from a virtual shopping cart, dwelling at a certain web page for more than a predetermined length of time, rendering certain content, rendering a certain sequence of content, filling out a form, or issuing a particular command. The customer information may include an Internet protocol address of the customer terminal, a video capability of the customer terminal, and / or a browser type used by the customer terminal.

Owner:RAKUTEN INC

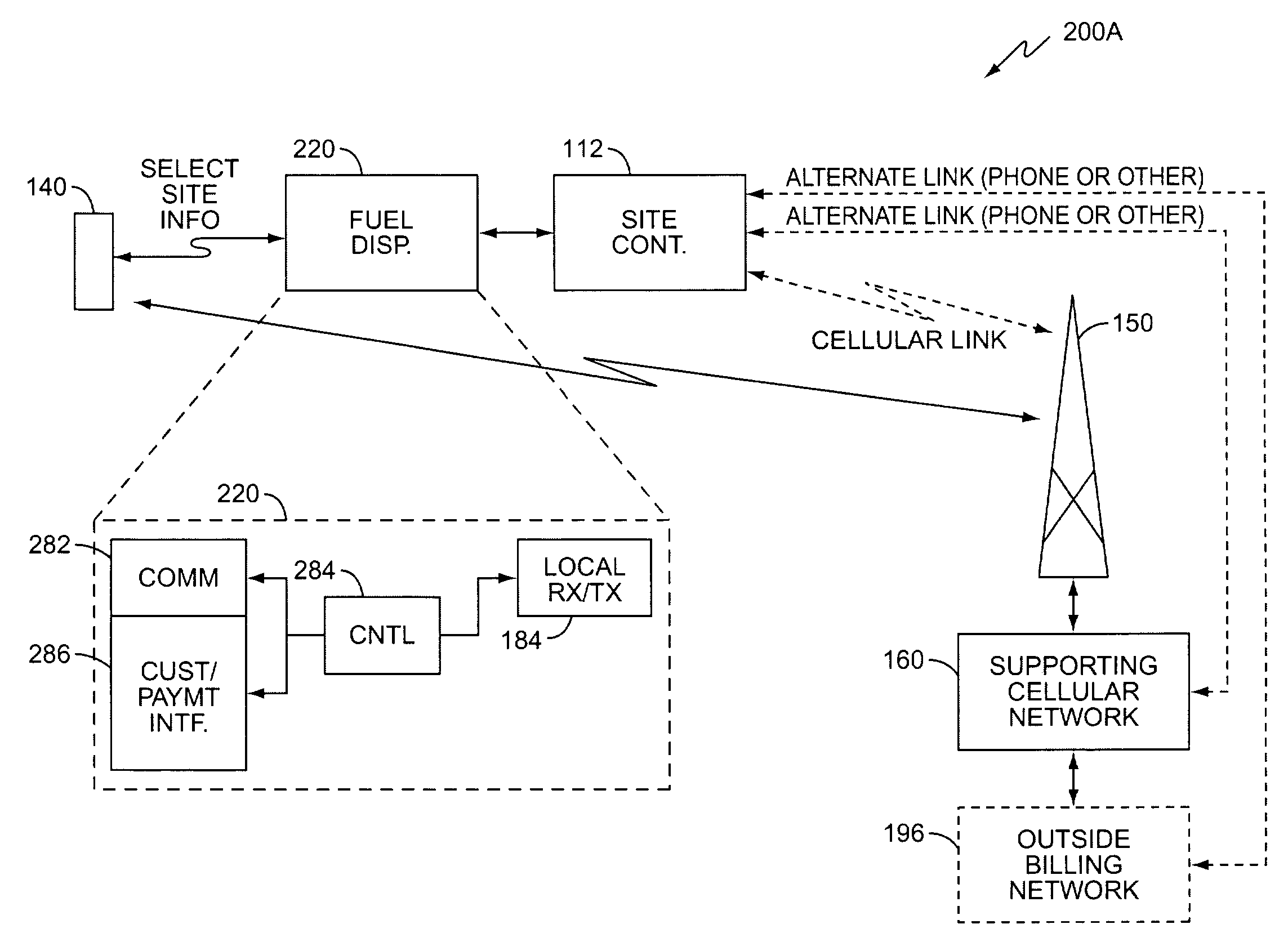

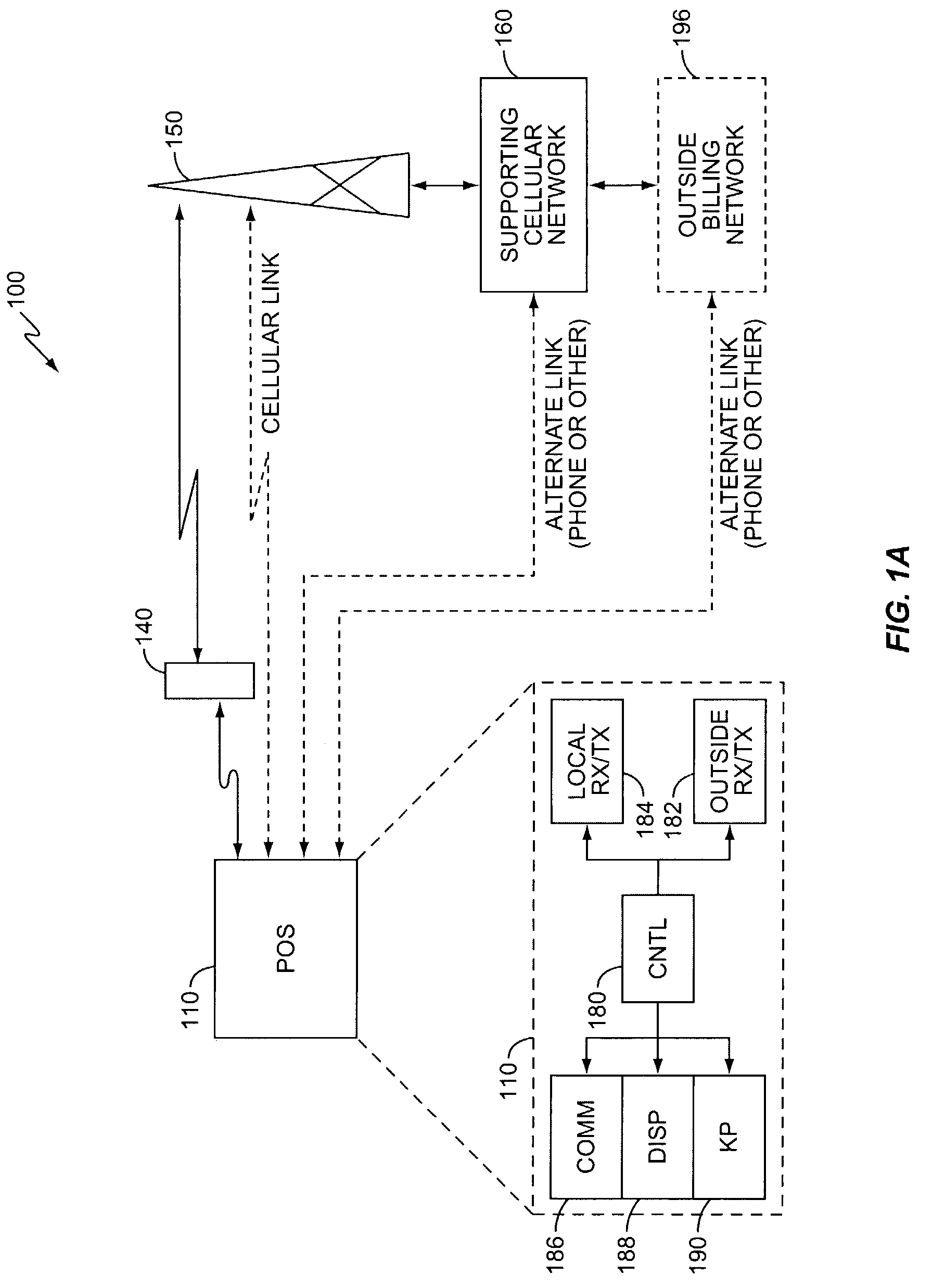

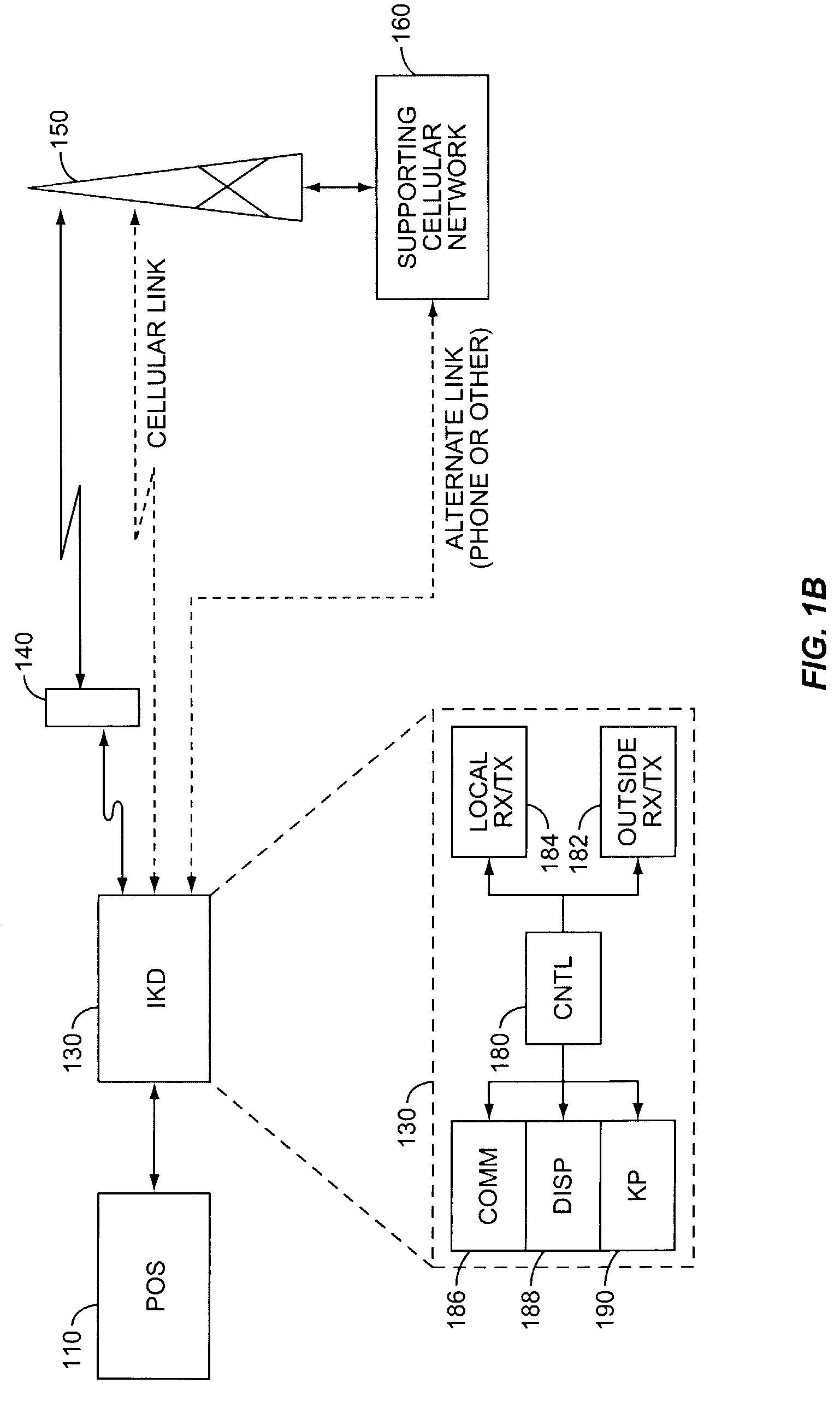

Cellular telephone-based transaction processing

InactiveUS7039389B2Telephonic communicationCredit schemesTelecommunications linkFinancial transaction

A retail transaction system provides enhanced customer convenience and increased transaction security by sending transaction information to a cellular network provider via a customer's digital cellular phone. For example, a fuel dispenser is equipped with a communications link allowing direct communications to a customer's cellular phone. When a customer desires to conduct a transaction using the fuel dispenser, the fuel dispenser transmits select information to the customer's cellular telephone using this communications link. A telephone number is included in the select information. When the customer presses send, or otherwise causes their telephone to dial the number transferred from the fuel dispenser, the select information along with any additional customer information is sent to the cellular network. This information is used by the network to authorize a purchase transaction for the customer, such authorization information returned to the fueling station at which the fuel dispenser is located via a cellular link. For enhanced security, the customer may be required to input their PIN in order to complete the transaction. Notably, the PIN and the remainder of the transaction information sent from the customer phone to the cellular network is intrinsically secure due to the digital encryption employed by the digital cellular protocol. Optionally, the system may be configured to cause the customer's cellular phone to automatically dial the number transferred by the fuel dispenser. This capability may be enabled at the customer's option. The system may be extended to other retail systems including in-store point-of-sale systems (POS).

Owner:GILBARCO

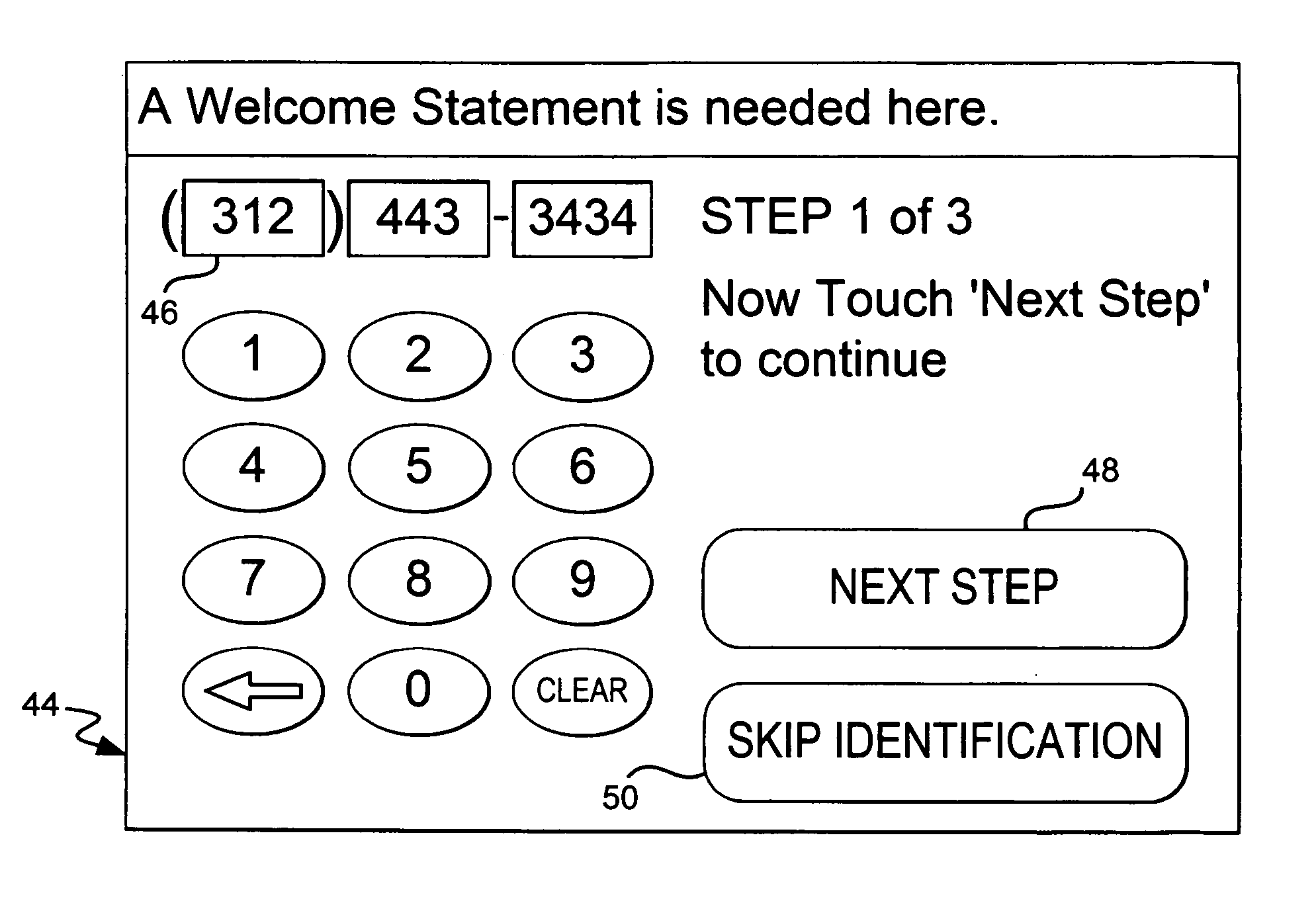

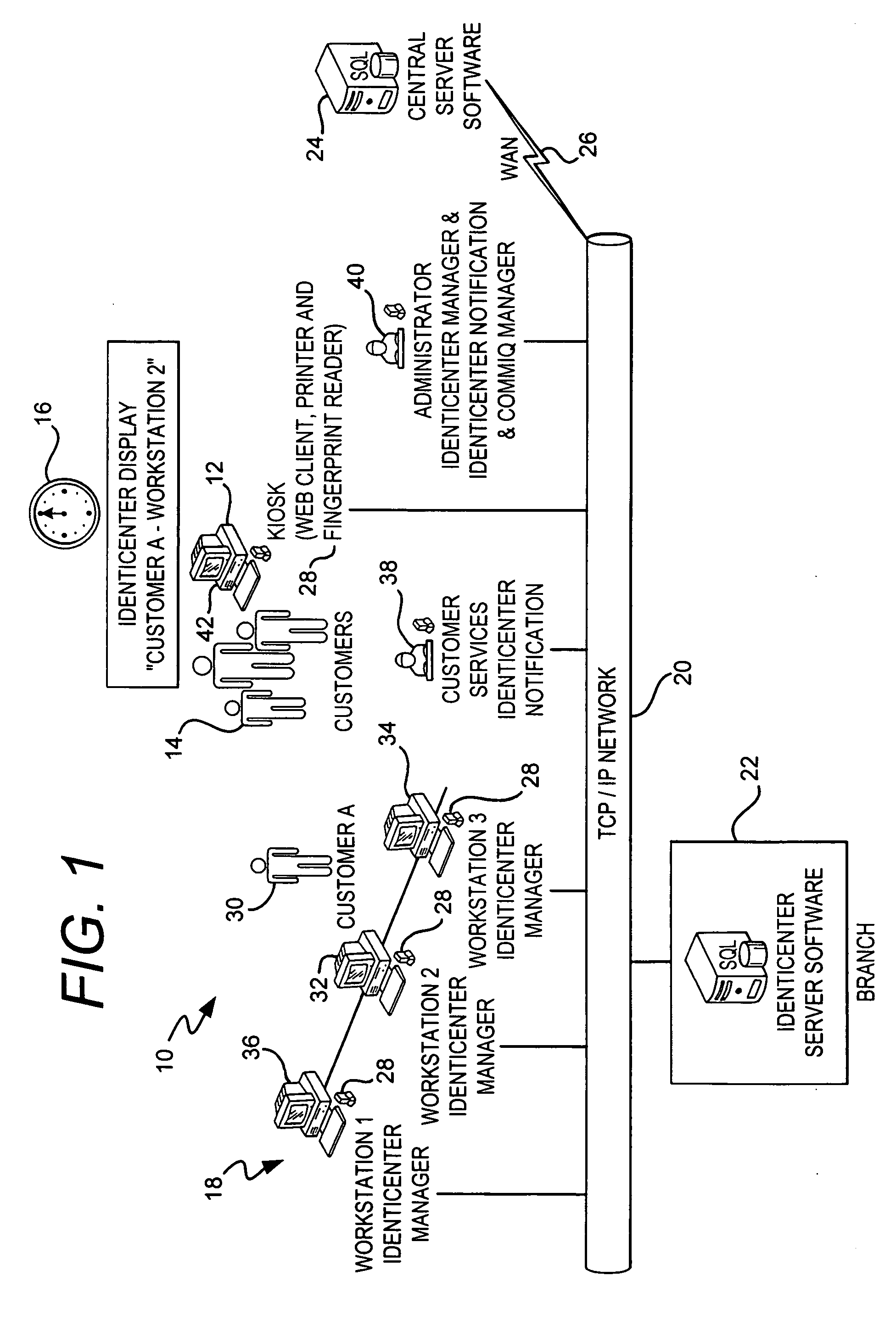

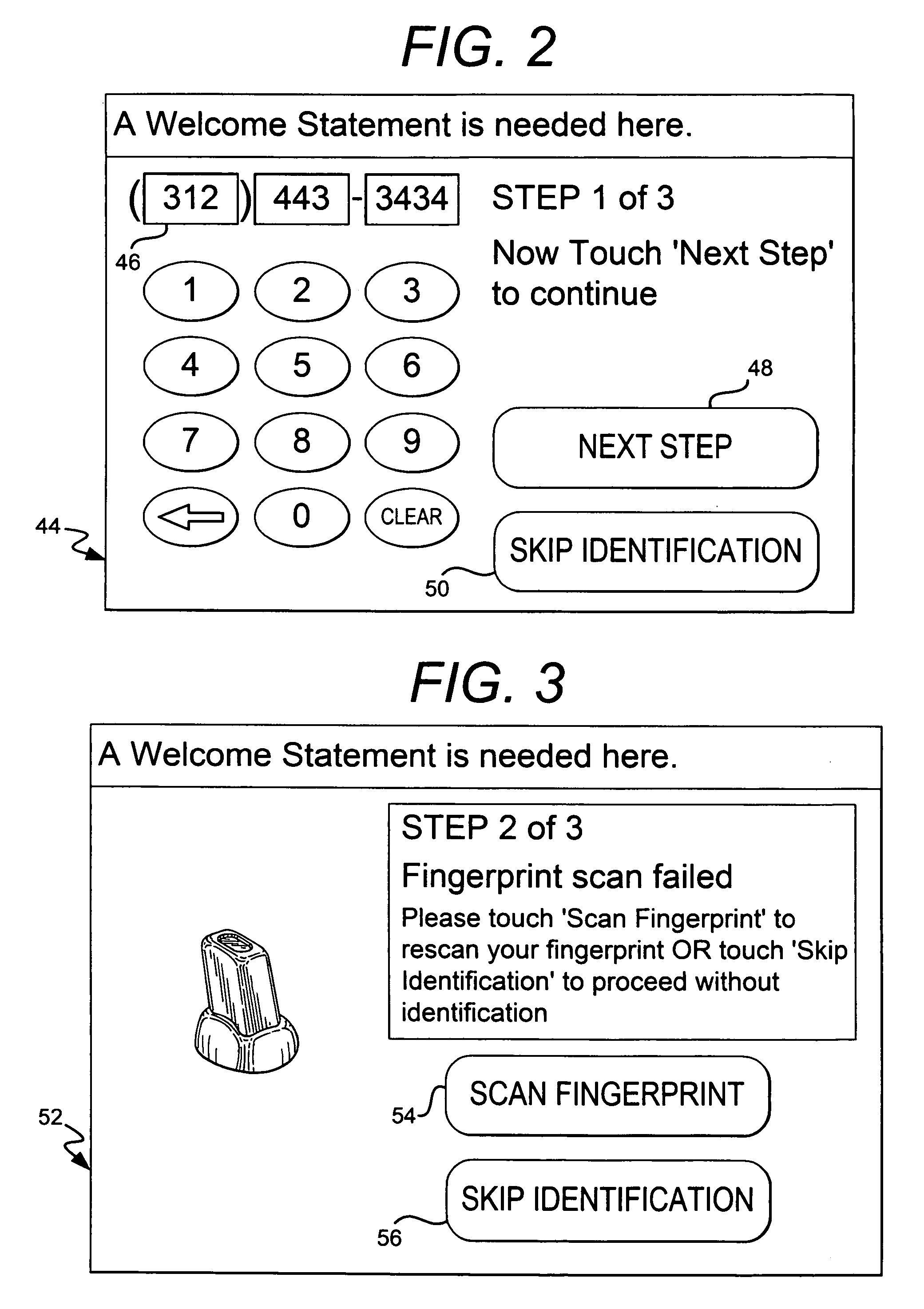

System and method for identifying and managing customers in a financial institution

InactiveUS20060253358A1Preventing account fraudAccurate identificationFinanceChecking apparatusCustomer informationLibrary science

A system and method for managing a customer in a banking institution. The system includes a customer kiosk with biometric device for identifying the customer. The system places the customer in a virtual queue to see a service provider.

Owner:US BIOMETRICS CORP

Computer-assisted funds transfer system

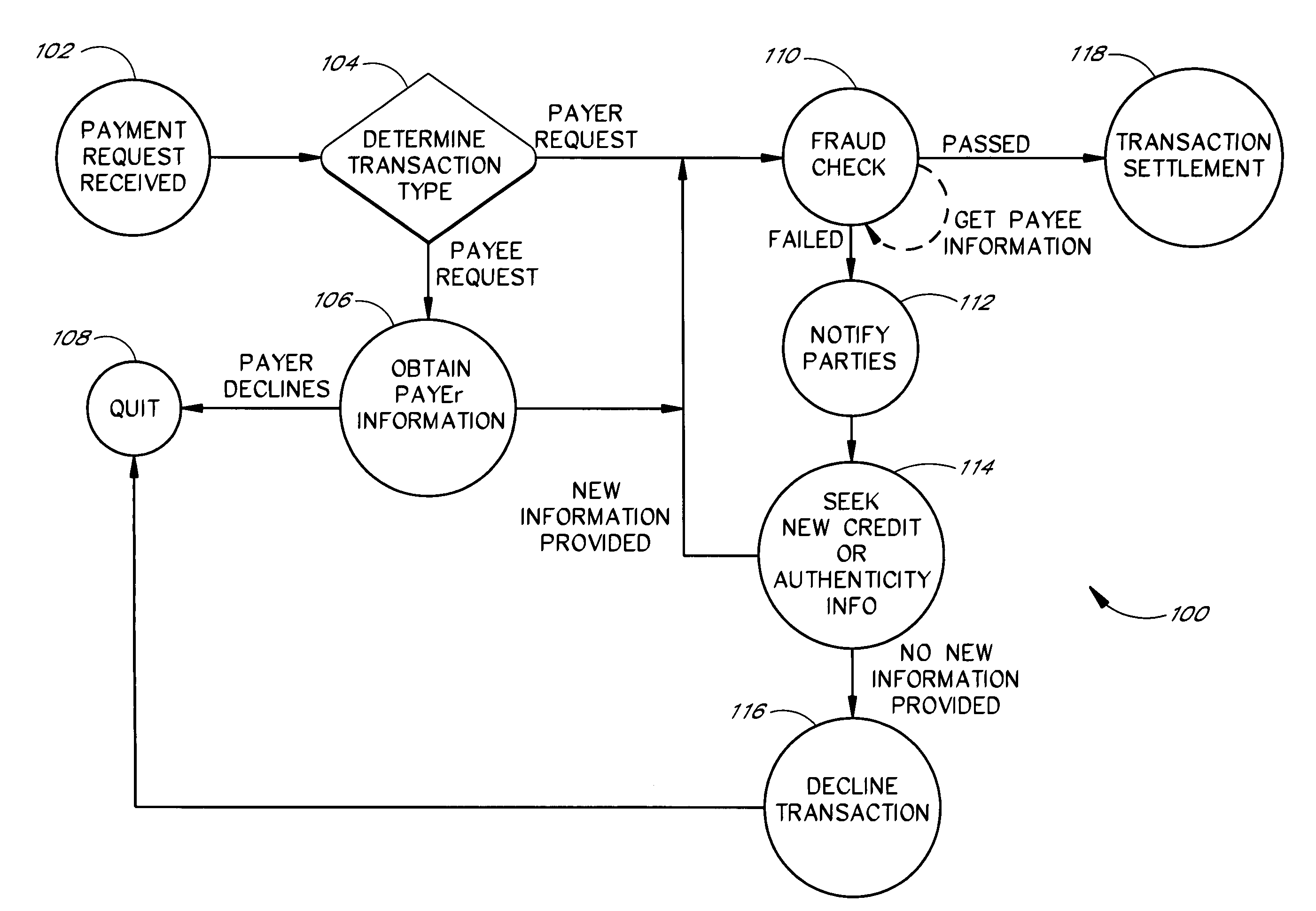

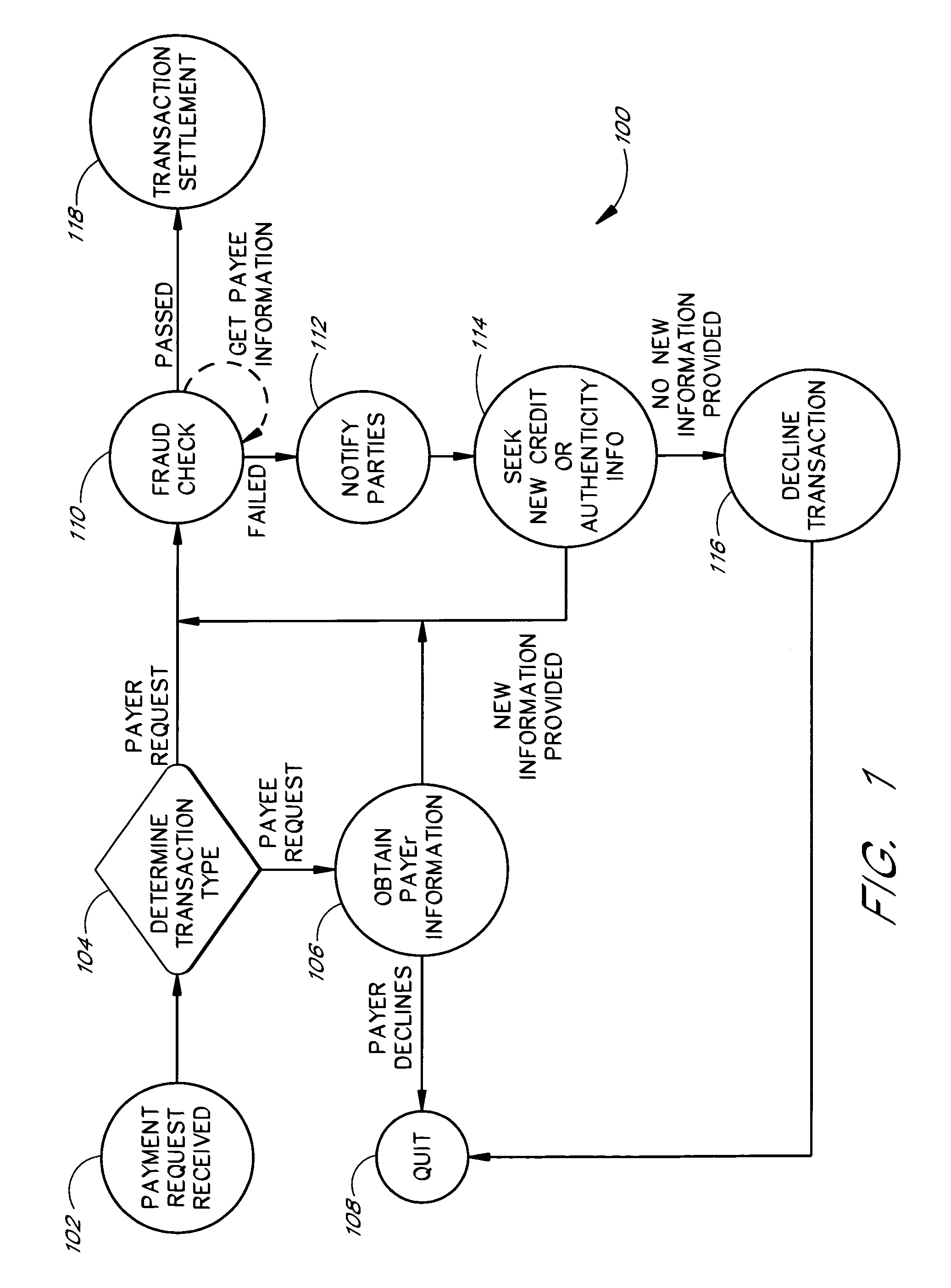

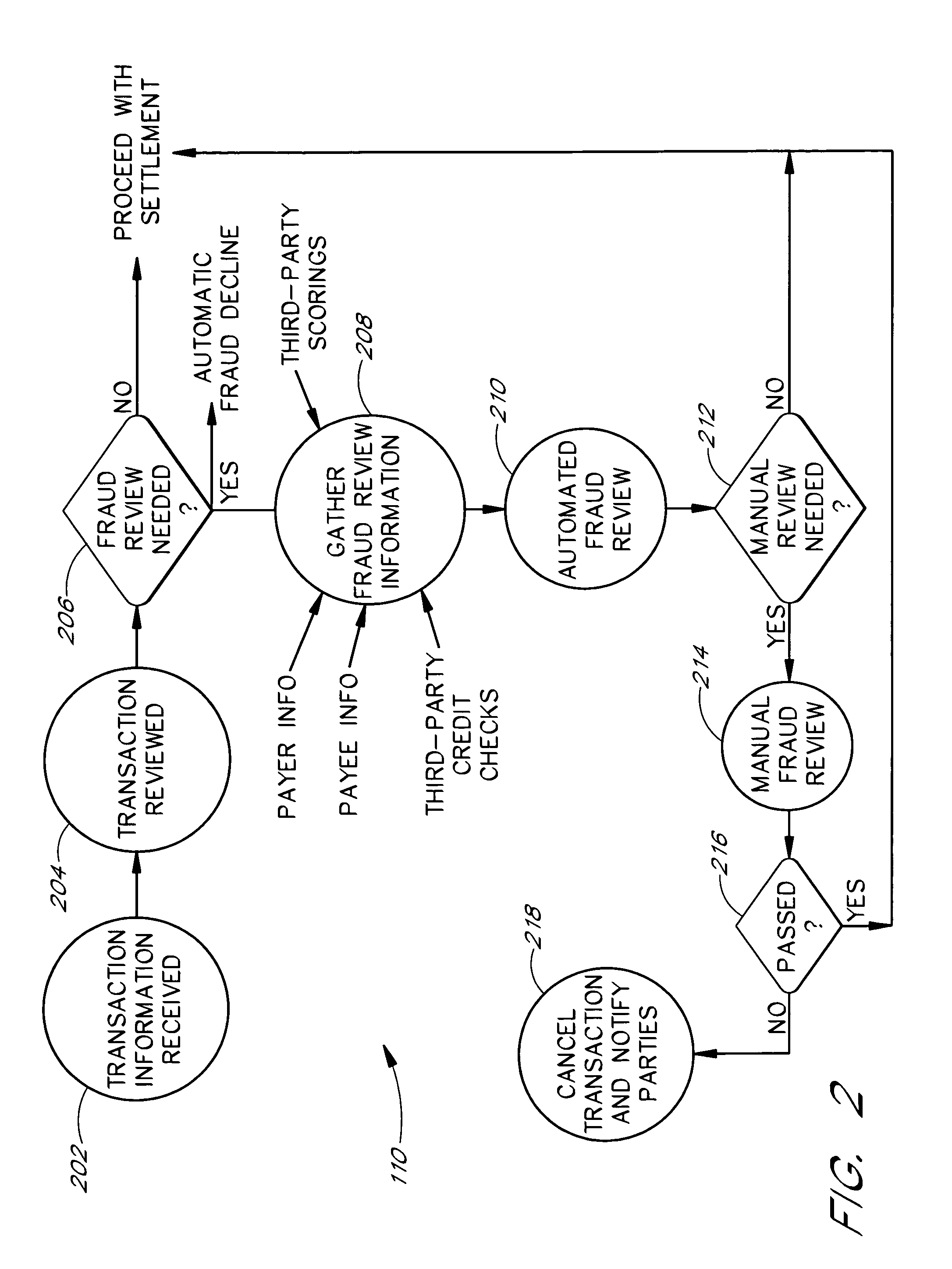

A payment request associated with a transfer of funds is received and a risk management assessment for both sides thereof is performed. If the risk management assessment procedure produces an adverse indication, the payment request is declined. Otherwise, the payment request may be processed for delivery of a payment associated therewith. The risk management assessment may be performed on the basis of credit / authentication information derived from customer information received with (or even prior to) the payment request. Such customer information may include credit card account information and / or bank account information (e.g., checking account) information. In some cases, the risk management assessment may include an automated component and a manual (non-automated) component. Such a manual component may be needed where the automated component of the risk management assessment provides suspect information regarding one of the parties to the transaction. Where the payment request is processed for delivery of the payment, such processing may include submitting a payment authorization request, and, upon receiving a settlement indication regarding that payment authorization request, transmitting the payment. In some cases, the payment may be transmitted as a check, while in others it may be transmitted as a money order or instruction to have funds automatically deposited in an account.

Owner:AMAZON TECH INC +1

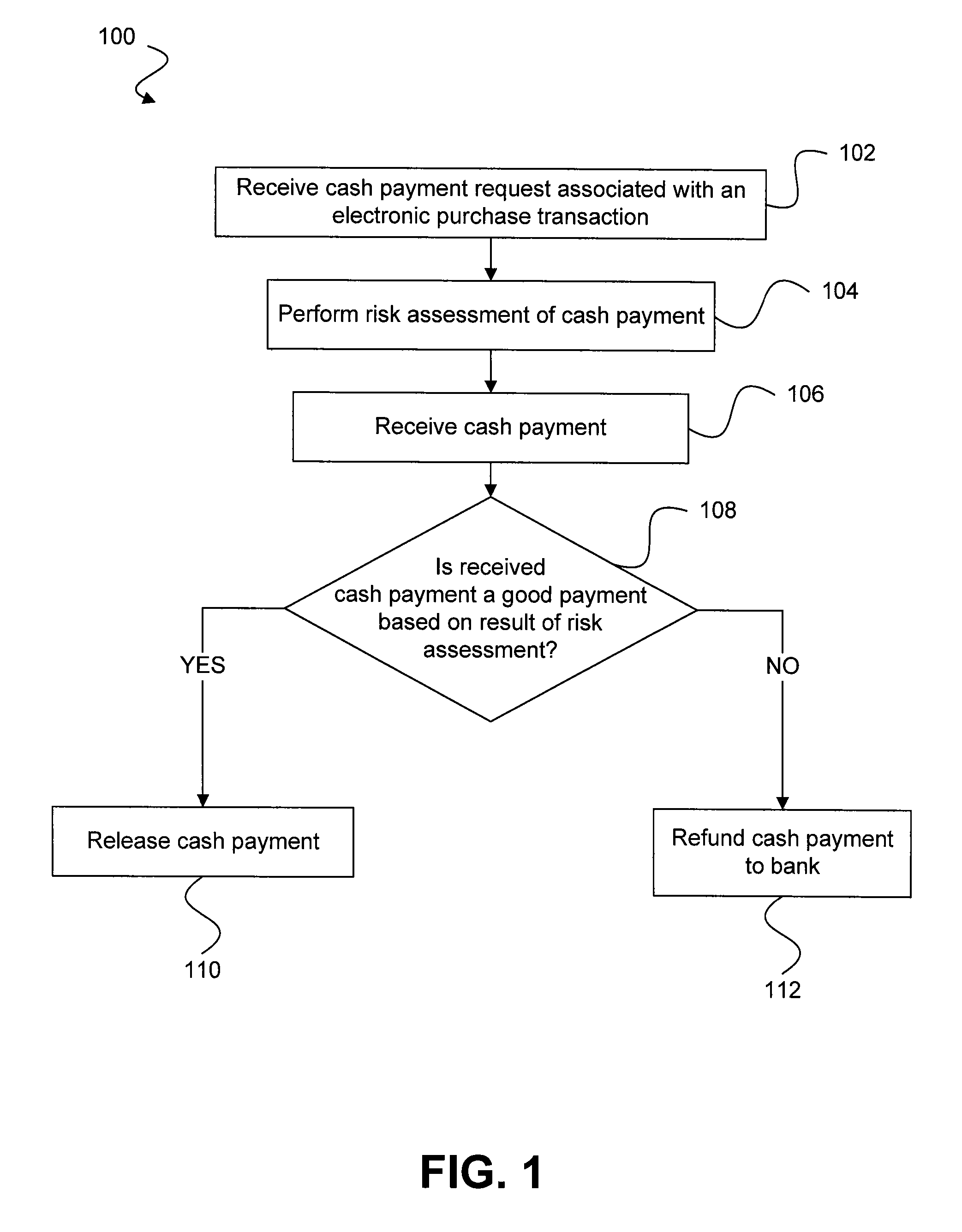

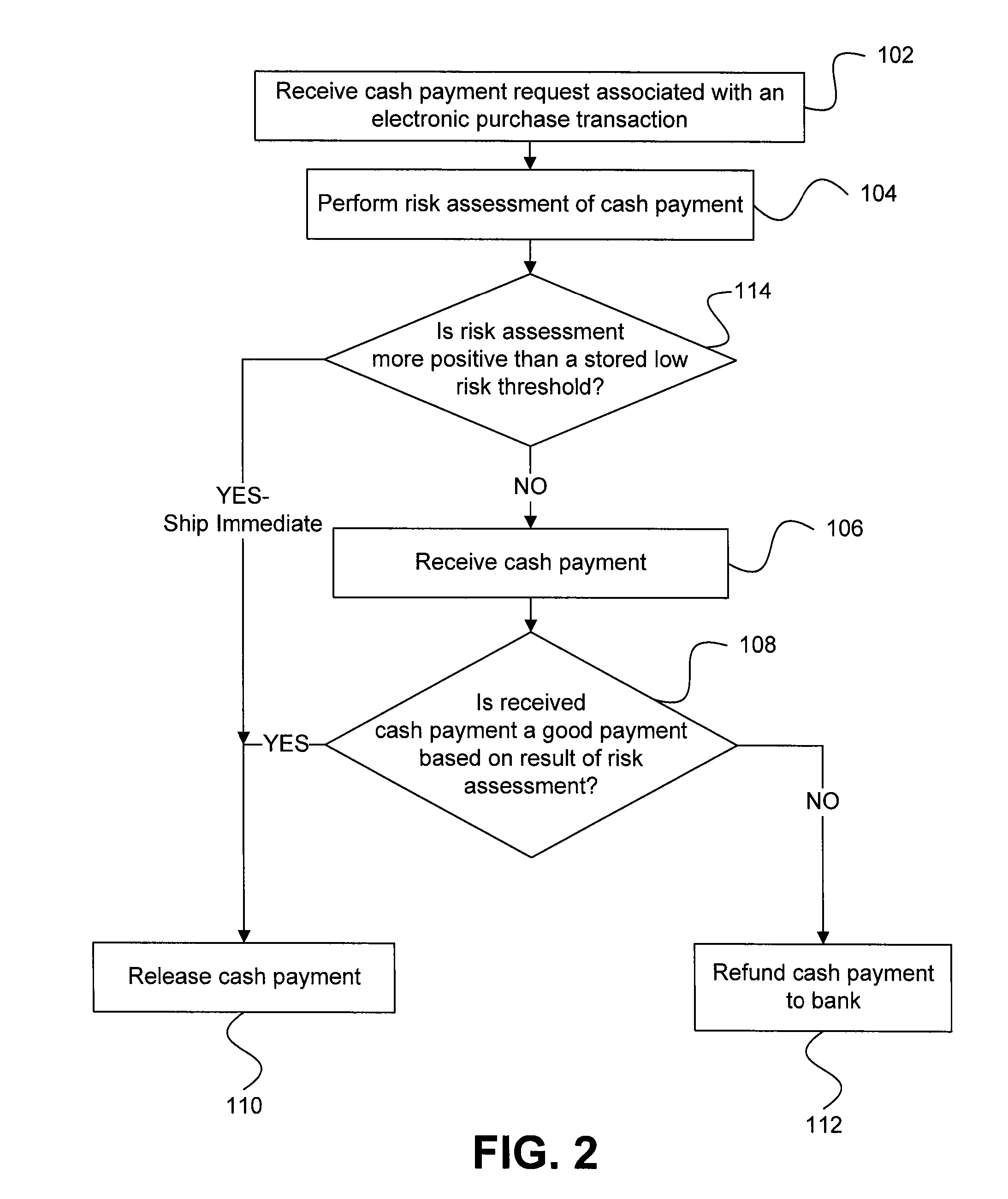

Risk detection and assessment of cash payment for electronic purchase transactions

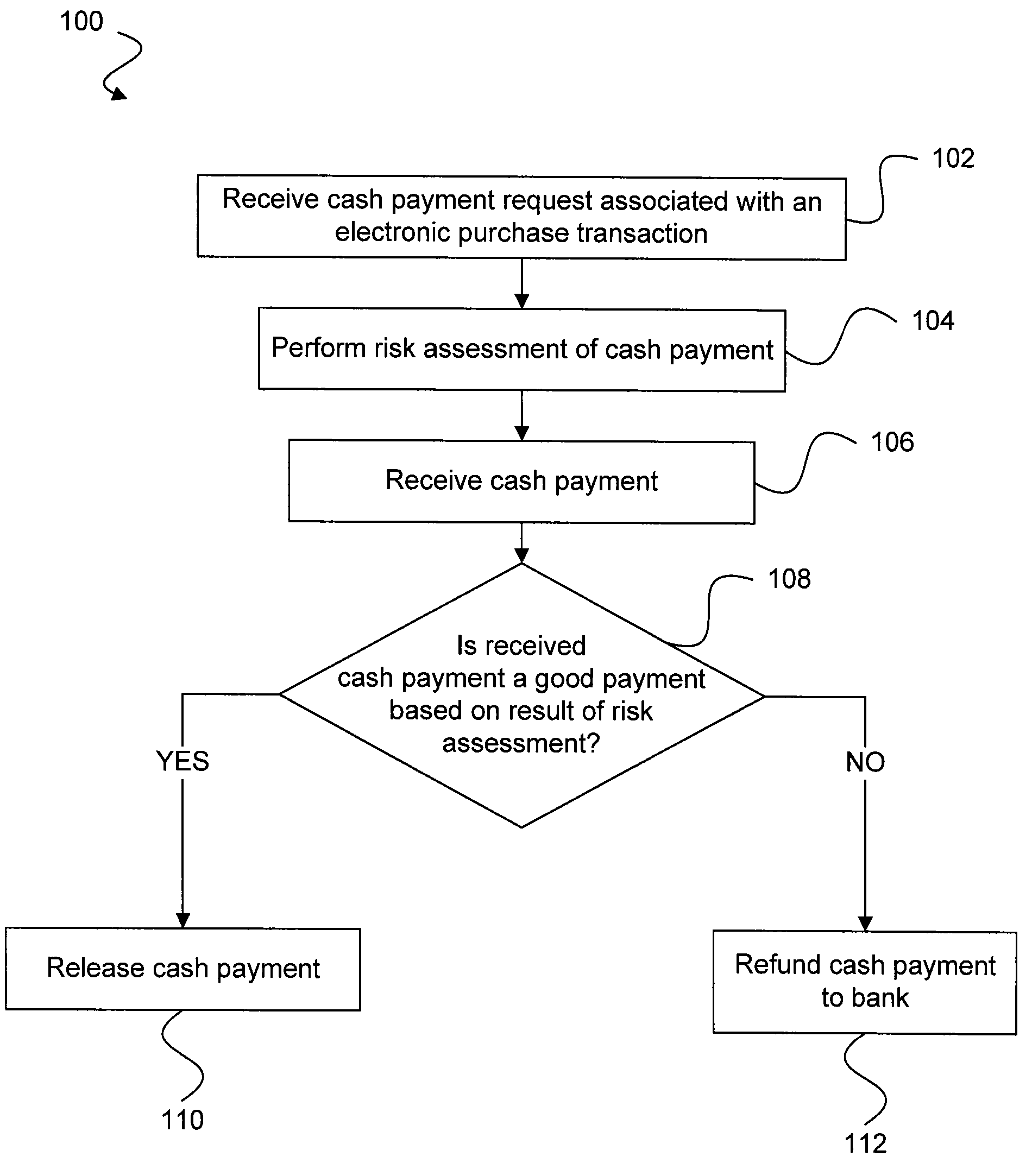

A system and methods are provided which allow consumers to pay for ecommerce transactions through online bill payment and for merchants to determine that payments are not fraudulent. The system and methods do not rely on personal or confidential customer information relating to credit-cards and / or bank account routing information, date of birth and / or social security number. A risk manager can perform risk assessment for the cash payment based on order information and non-confidential purchaser information included in a cash payment request. In response to receiving an indication of the cash payment from the purchaser, a determination is made whether the cash payment is a good payment based on the risk assessment. The cash payment is released to a merchant in response to a determination that the cash payment is a good payment.

Owner:WESTERN UNION FINANCIAL SERVICES

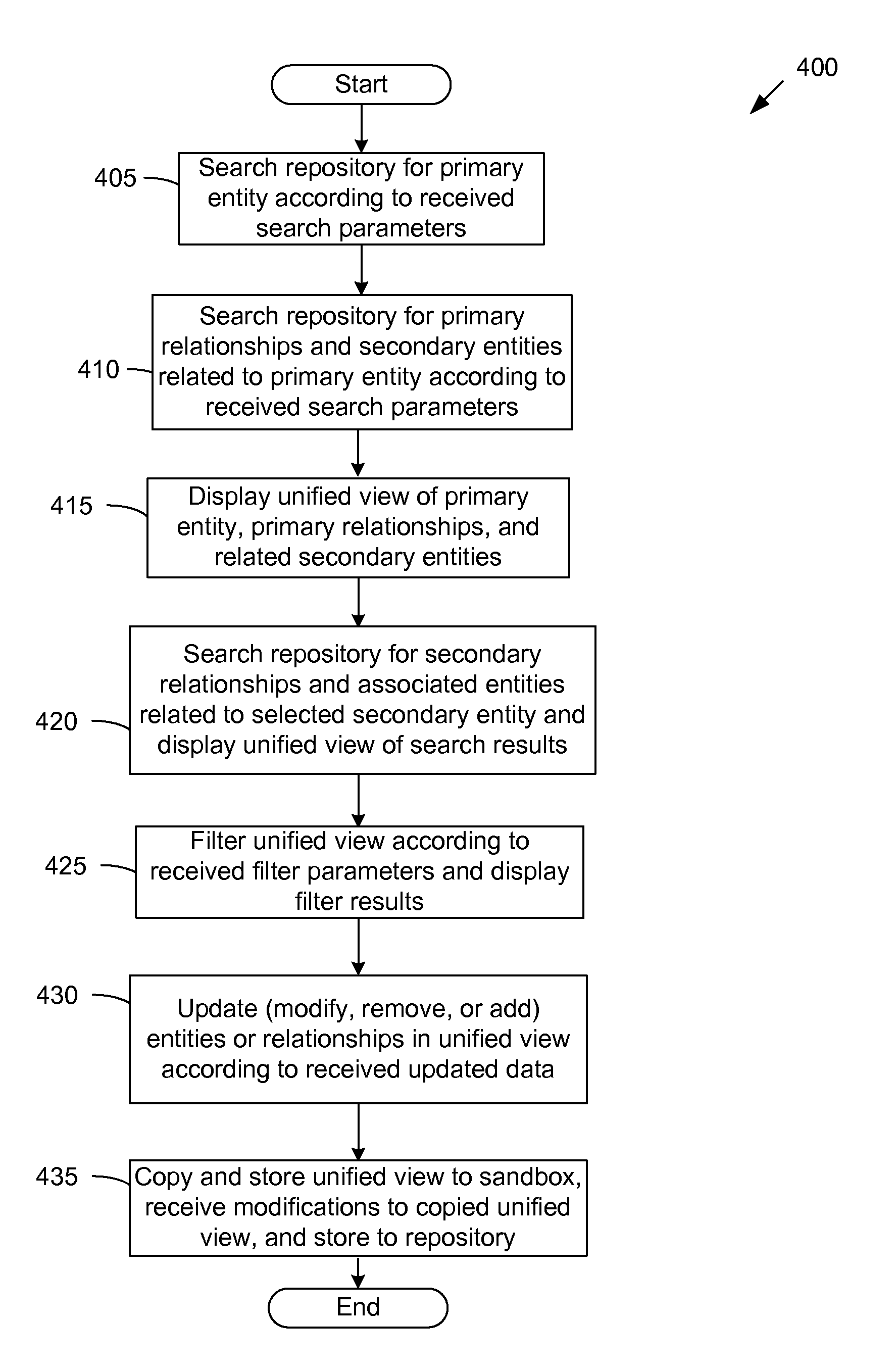

Searching, filtering, creating, displaying, and managing entity relationships across multiple data hierarchies through a user interface

InactiveUS20070214179A1Digital data information retrievalDigital data processing detailsGraphicsEntity–relationship model

A method and system for searching, filtering, creating, displaying, and managing entity relationships from a repository of data hierarchies through a user interface is provided. Relationships of a primary entity and its related secondary entities are retrieved and displayed in a unified view in graphical or text view. The unified view may indicate a “cross” relationship between first and second entities through another entity that connects the first and second entities, the first and second entities originating from different data hierarchies and / or data sources. Relationships of a selected secondary entity may be displayed in a unified view and entities or relationships may be updated or stored to a separate storage area. The method and system may be used within an enterprise for implementing Master Data Management or Customer Data Integration for managing data hierarchies containing customer information, human capital information, supplier information, asset information, product information, or financial information.

Owner:INFORMATICA CORP

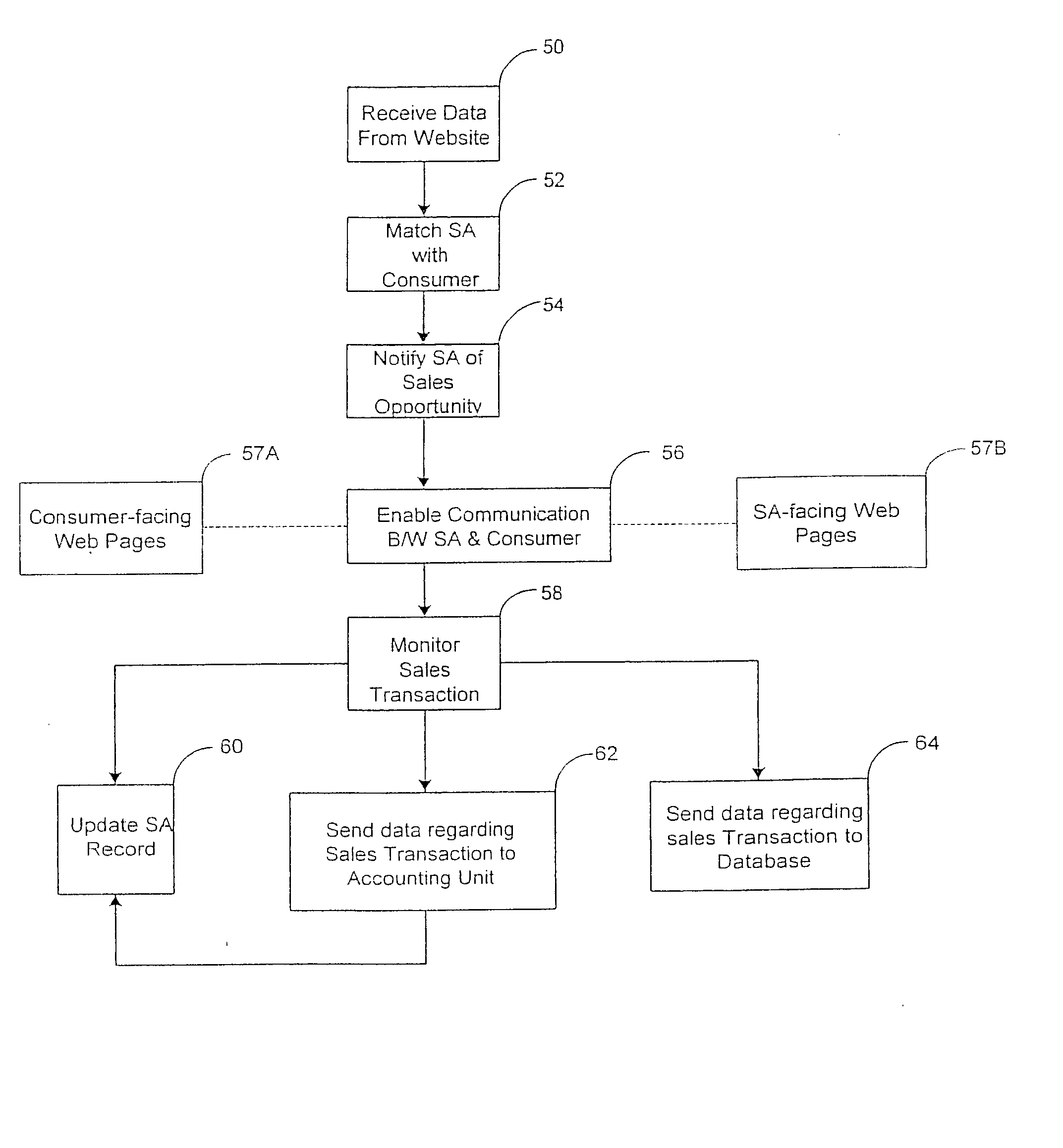

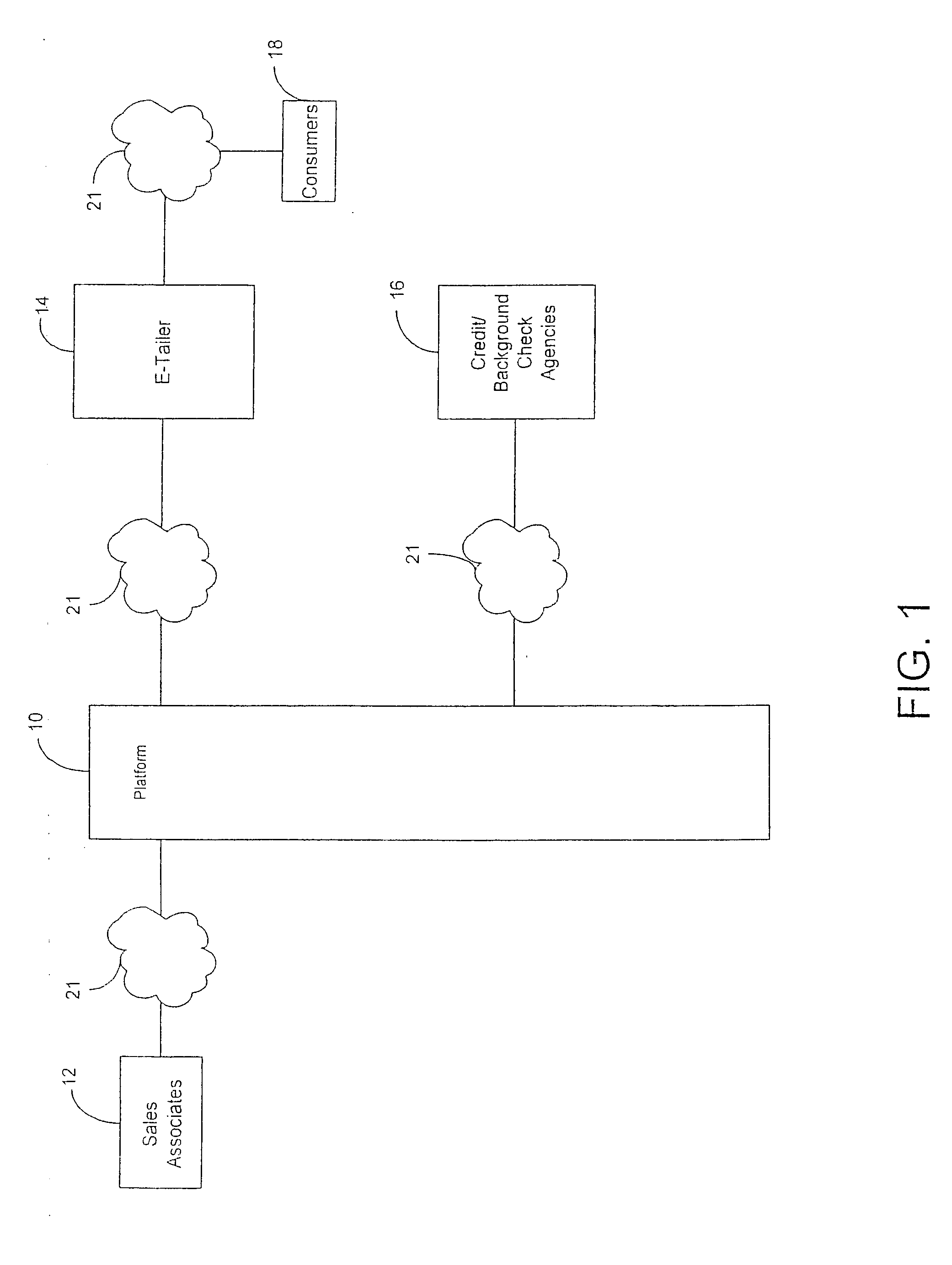

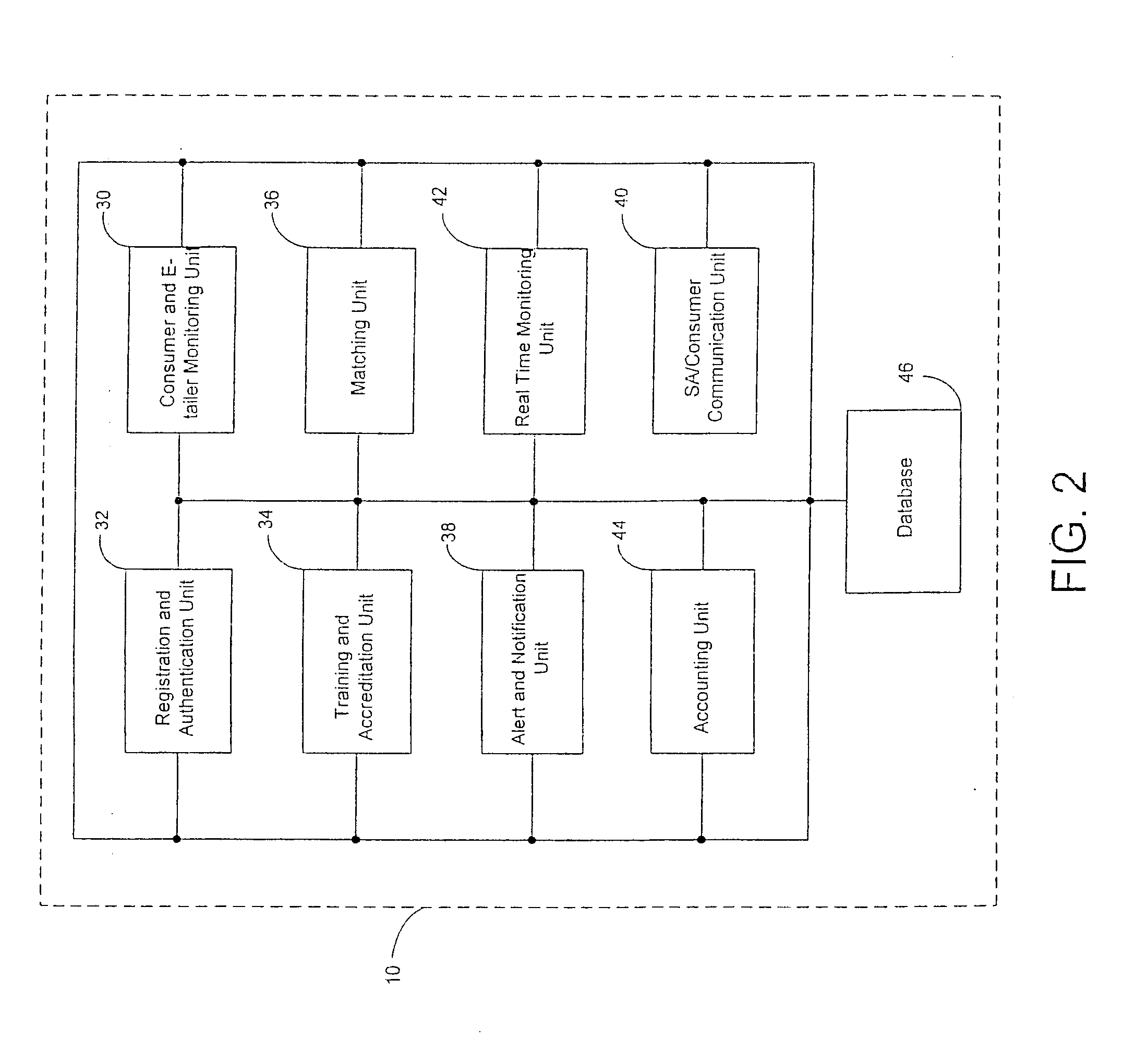

Systems and methods to facilitate selling of products and services

InactiveUS20050097000A1Easy to communicate in real timeIncrease expensesCustomer relationshipBuying/selling/leasing transactionsWeb siteVoice over IP

The system of the present invention provides systems and methods for selling goods and services on, over, through, and in conjunction with the Internet. The system receives session (clickstream) information on a customer's website session from the enterprise's website and may also receive customer information on the customer from the enterprise's CRM or eCRM system. The session information referred to comprises the goods or services the customer is searching and metadata about such search and the relevant products, such as the surfing pattern itself. The system determines from the received information, based on the interaction between matching rules created using the system by the enterprise and the system's matching engine, whether the customer is a candidate for assistance from a sales associate. The system creates and indexes information on available sales associates and their performance, selling capabilities and product expertise. The system further matches the customer with at least one sales associate, ideally the most appropriate sales associate, based on the customer, session, and sales profile associate information, and facilitates communication between the sales associate and the customer. Additionally, the system provides information on the customer, products or services the customer is interested in, and the collateral sales materials (both internal and external to the enterprise) and selling techniques to the sales associate based on the particular sales opportunity. The system facilitates communication between the sales associate and the customer on the basis of chat, voice over IP, email and the public switched telephone network, including the concept of bridging a chat session into a PSTN conference call during which call the sales associate and customer maintain a co-browsing session with regard to the opportunity over the Internet.

Owner:LIVEPERSON

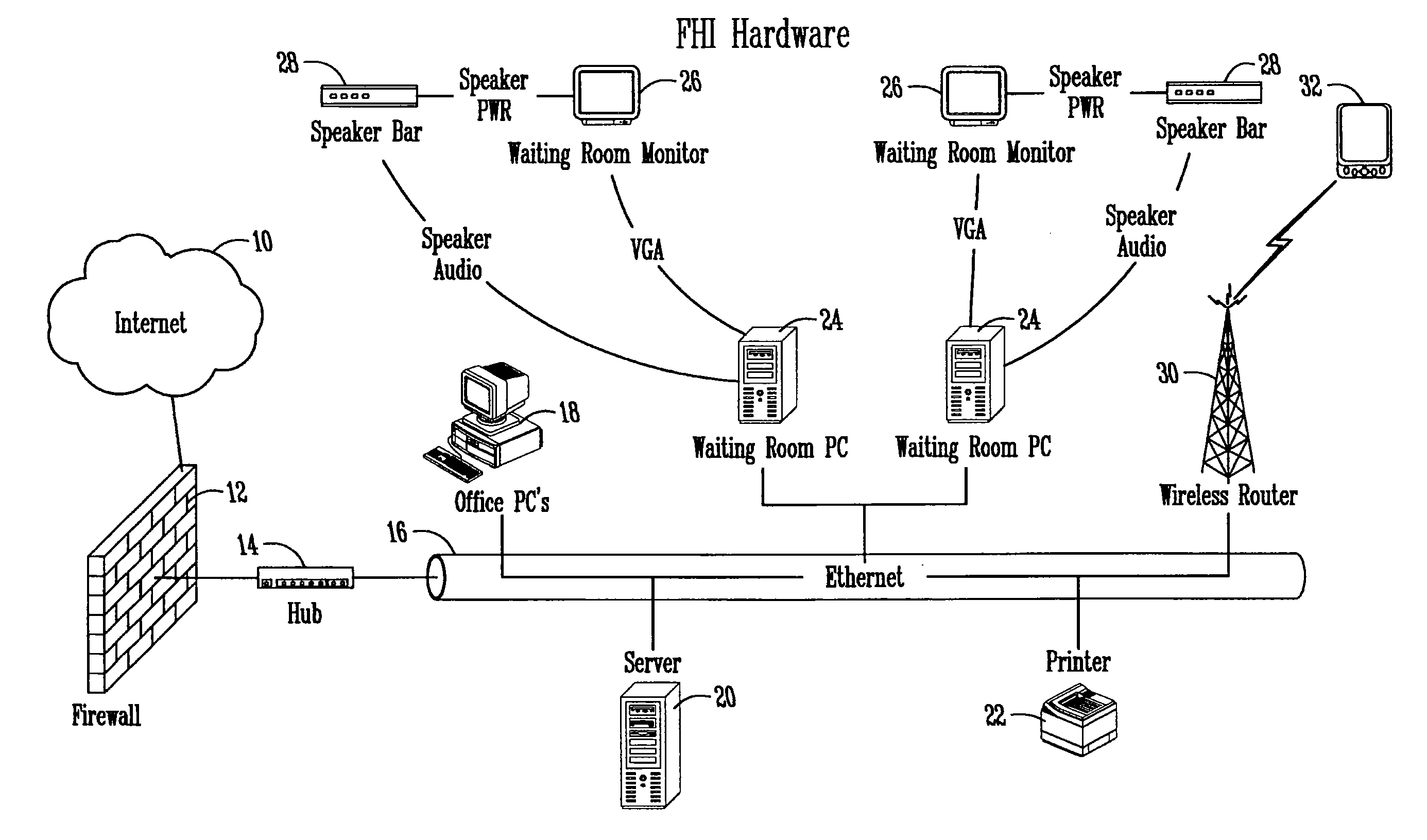

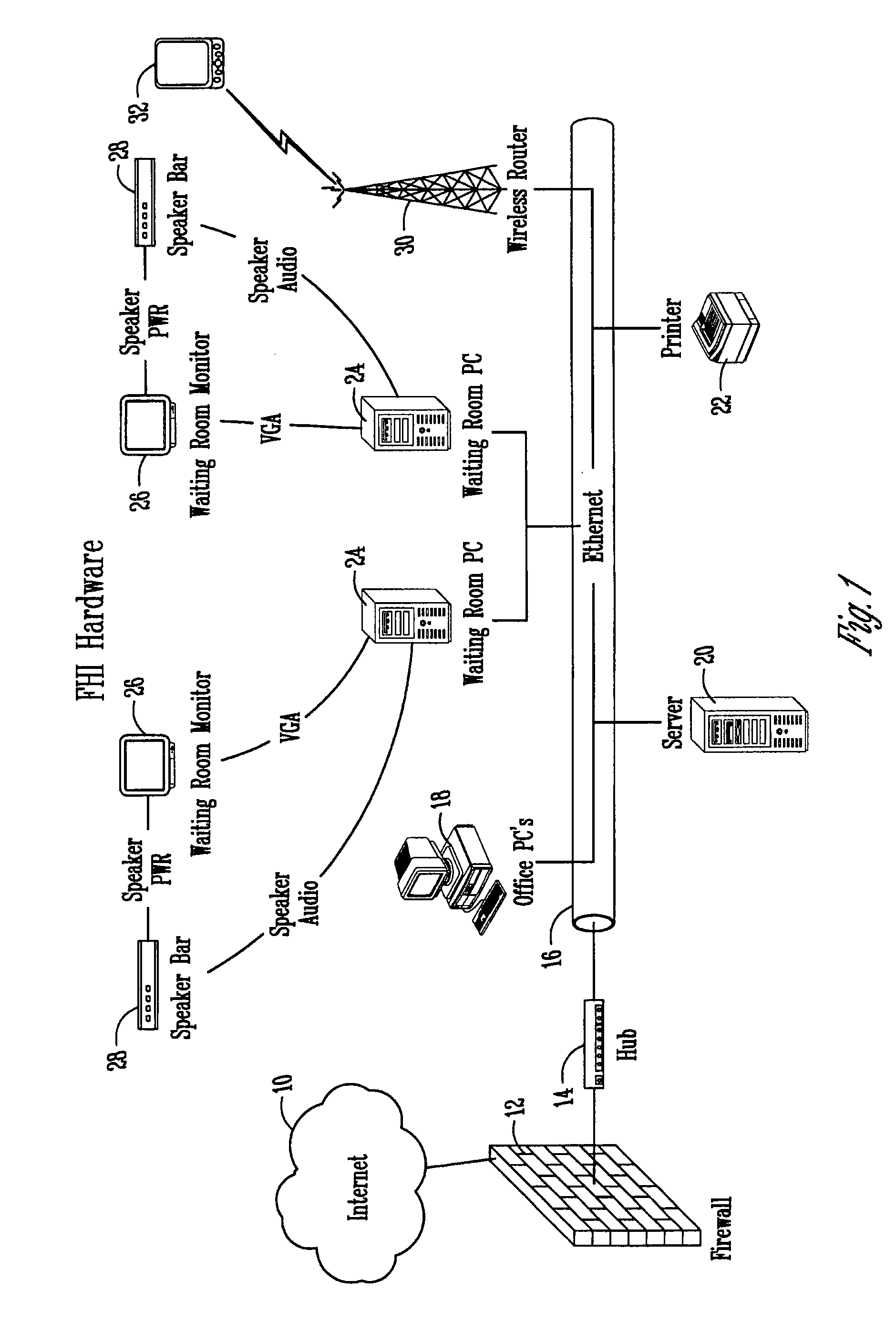

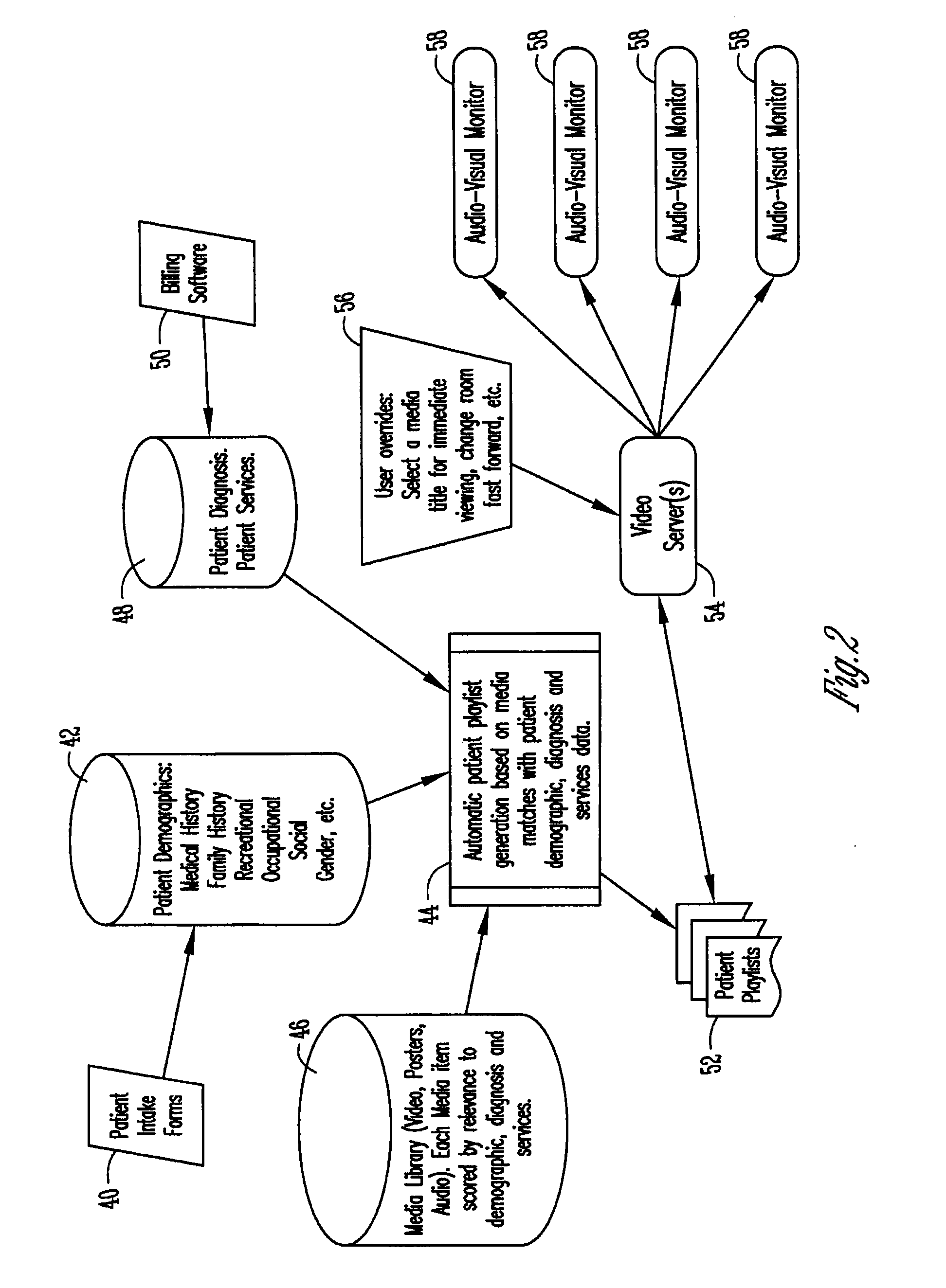

Apparatus and method for digital imaging, education, and internal marketing software and system

InactiveUS20070174079A1Meet actual needsEfficient managementPatient personal data managementOffice automationDigital imagingSelection criterion

A method and system for automatically managing multiple different functions of an office by storing or linking together multiple different types of data that is normally stored separately, such that summary reports requiring data from fields normally not stored together can be created efficiently and effectively, and a method and system for automatically selecting client education, marketing or other business-related information or materials from a stored collection of such information or materials based on selection criteria established by the business, such that the selected information or materials are targeted to the specific client based on demographic and other client information and scheduling and other business information. In one aspect of the invention, a patient education module has a library of content on hand. The information and materials play automatically to a designated monitor near the location of the client and the material viewed is documented in the client's electronic record with customized notation by user. The material viewed has a supportive component hand-out or supportive accompanying written information that is automatically printed at the receptionist desk at the time the material is viewed on the monitor by the client.

Owner:FUTURE HEALTH

Payment transaction client, server and system

InactiveUS20120150737A1Eliminate needLow implementation costFinancePoint-of-sale network systemsPayment transactionBarcode

The invention relates to a system for handling payment transactions, comprising a payment transaction client and a payment transaction server. A customer identifies himself by providing a code to a shop, preferably by a bar code. The shop sends customer identification, shop identification, client identification and the amount to the server. The server looks up further customer information, checks the balance on the account of customer and issues a payment confirmation code to the mobile telephone of the customer if the customer has enough credit on the account. The customer provides the code to the shop or directly to the client, upon which the client sends the payment confirmation code and further information like the information sent previously to the server. If the confirmation code received matches the confirmation code issues early, the server executes the payment or instructs a bank to execute the payment.

Owner:EURO WALLET

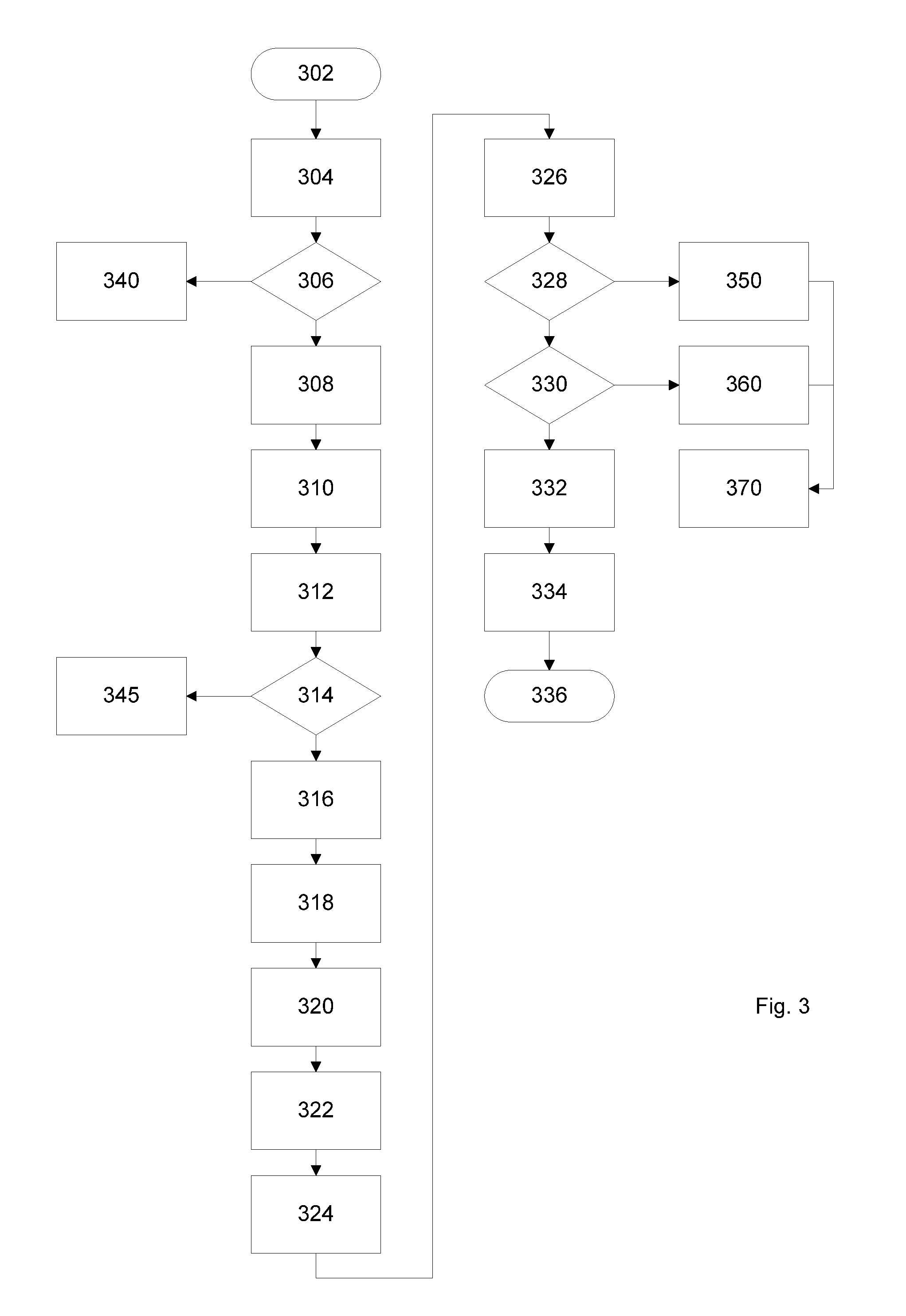

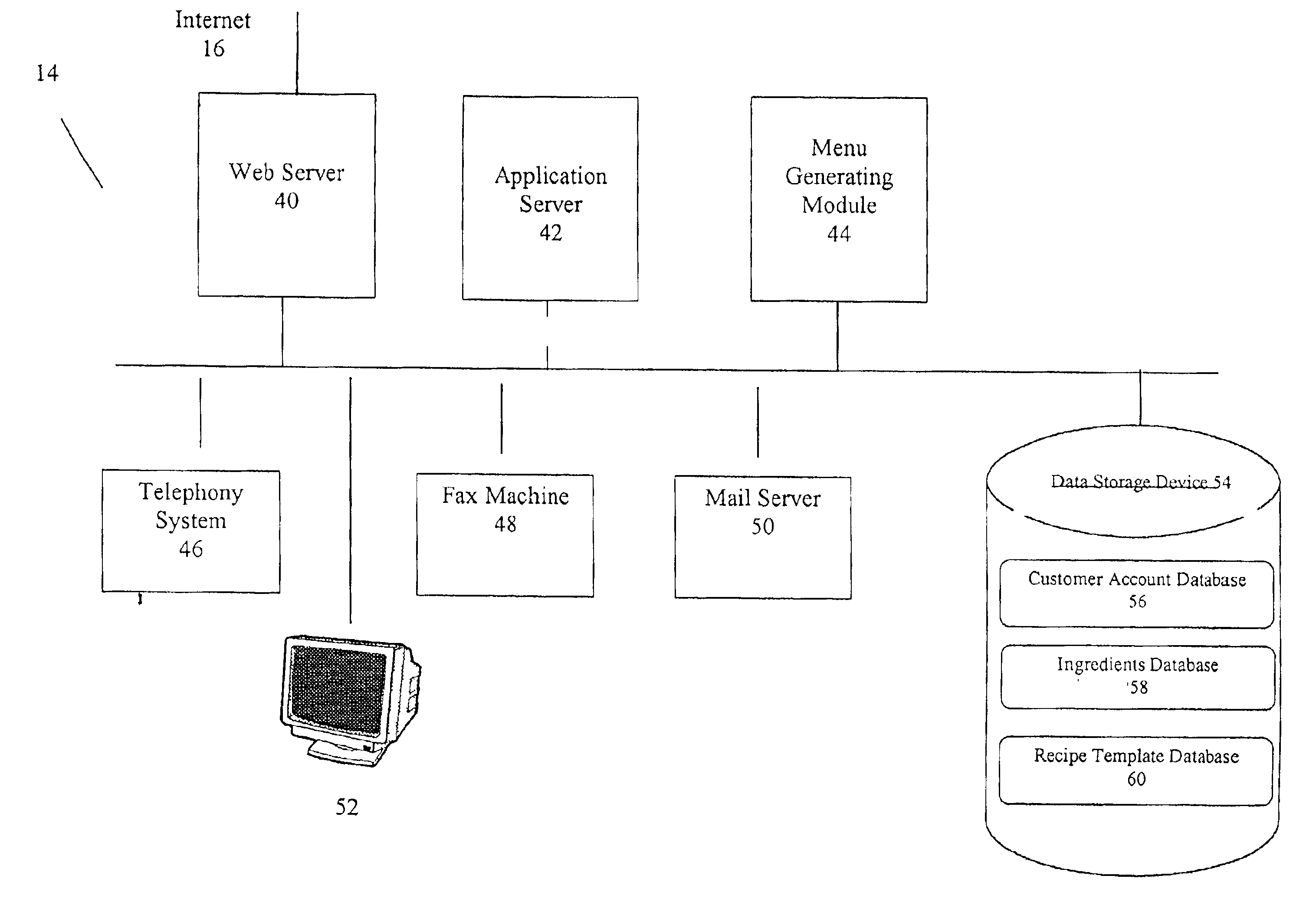

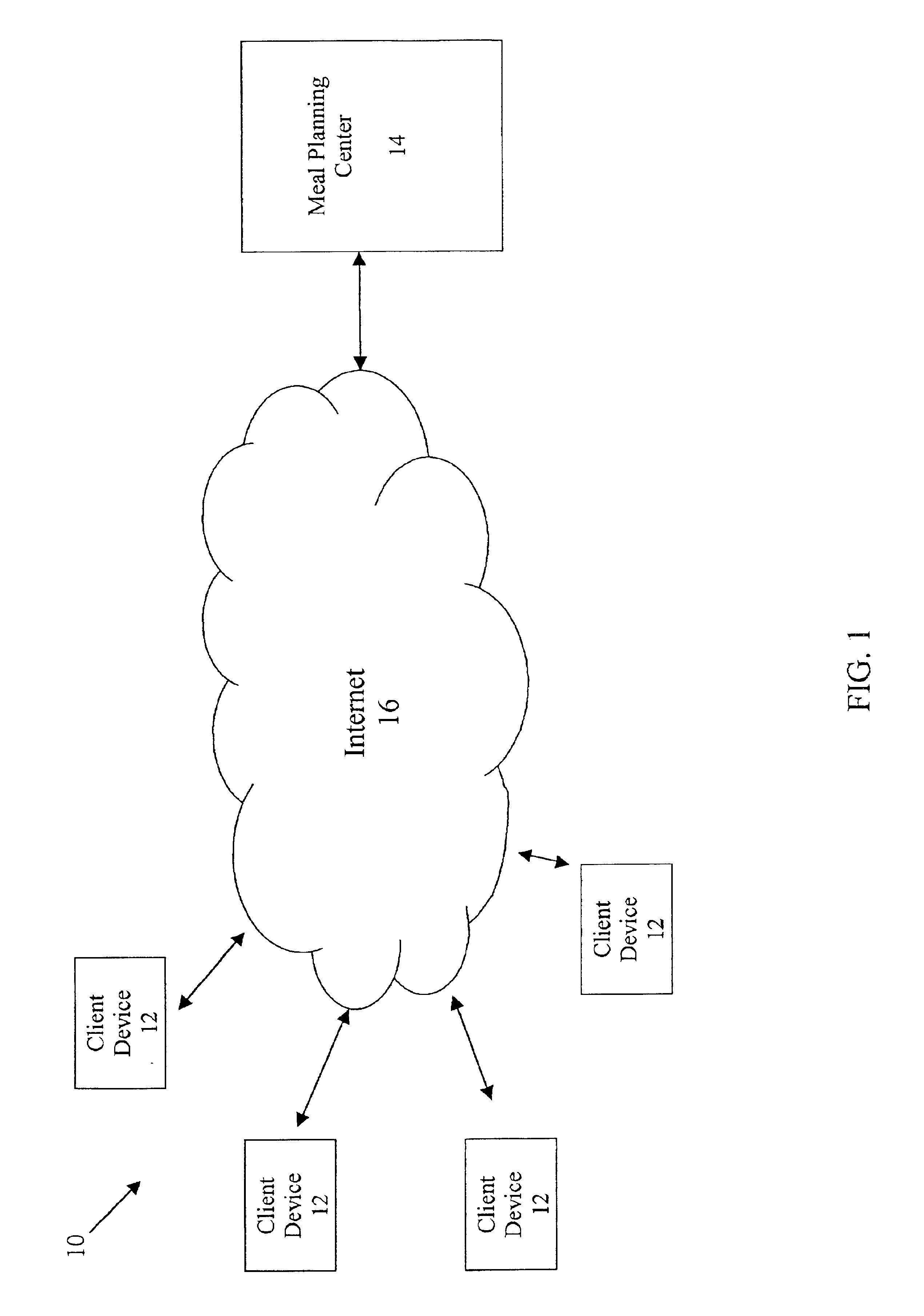

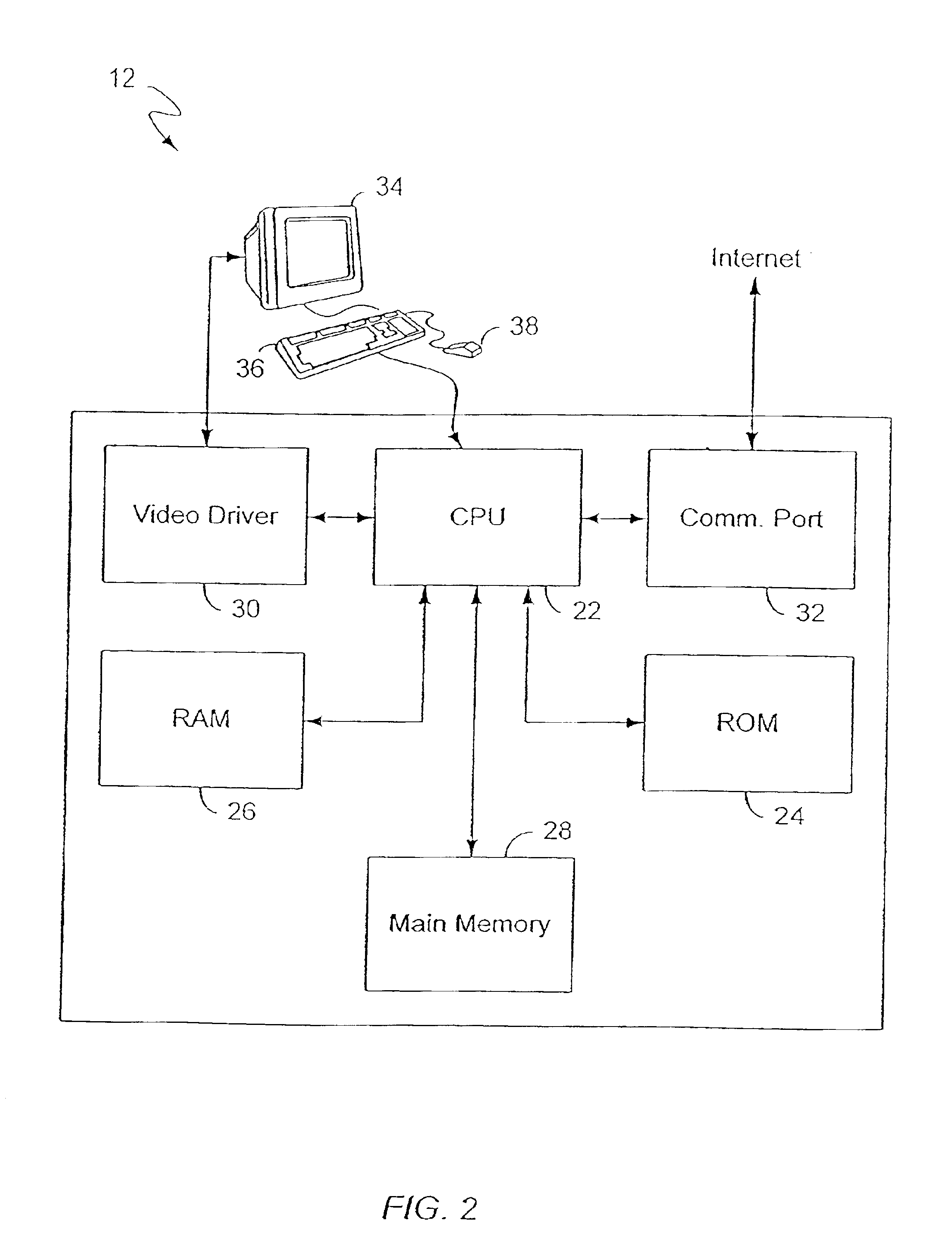

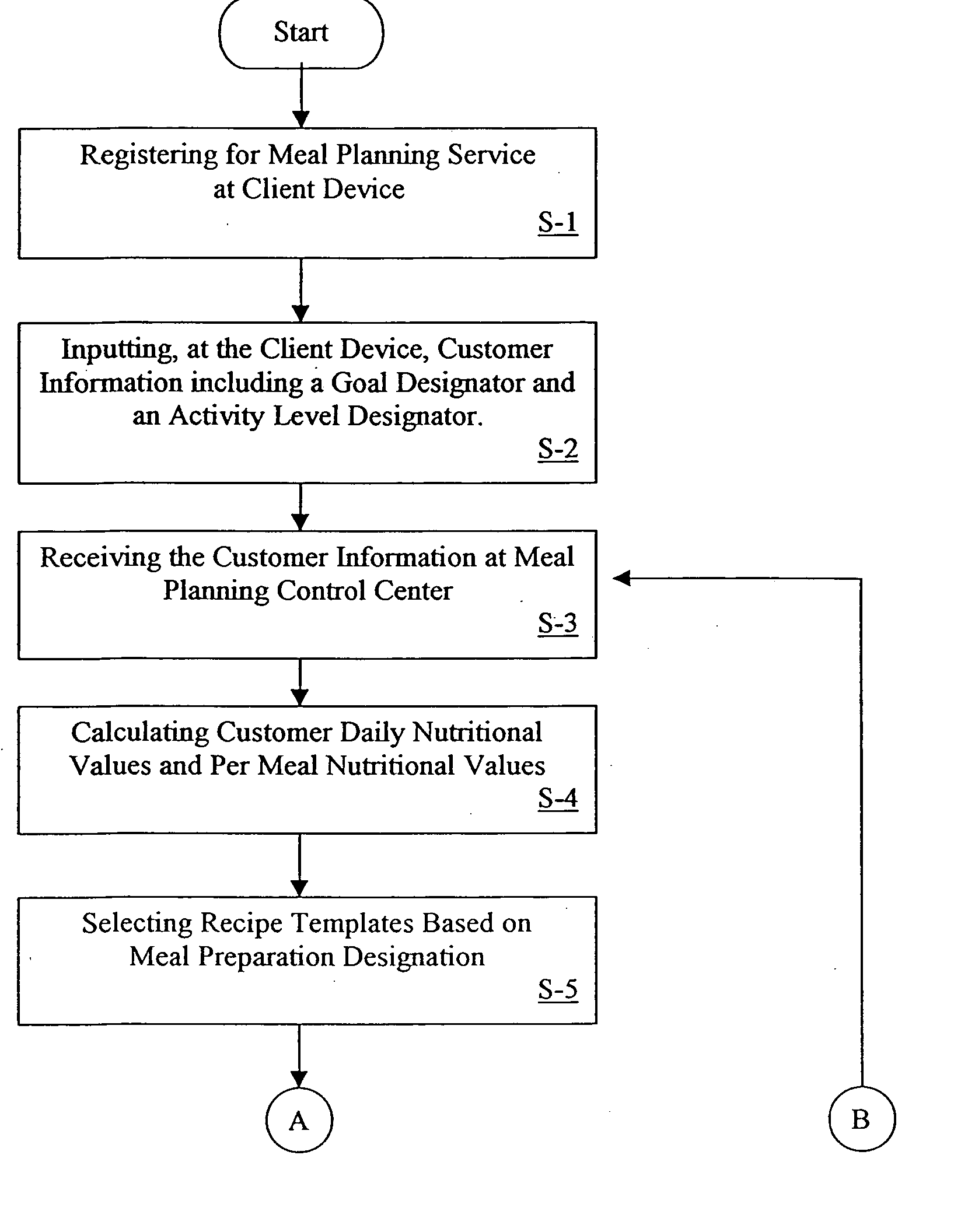

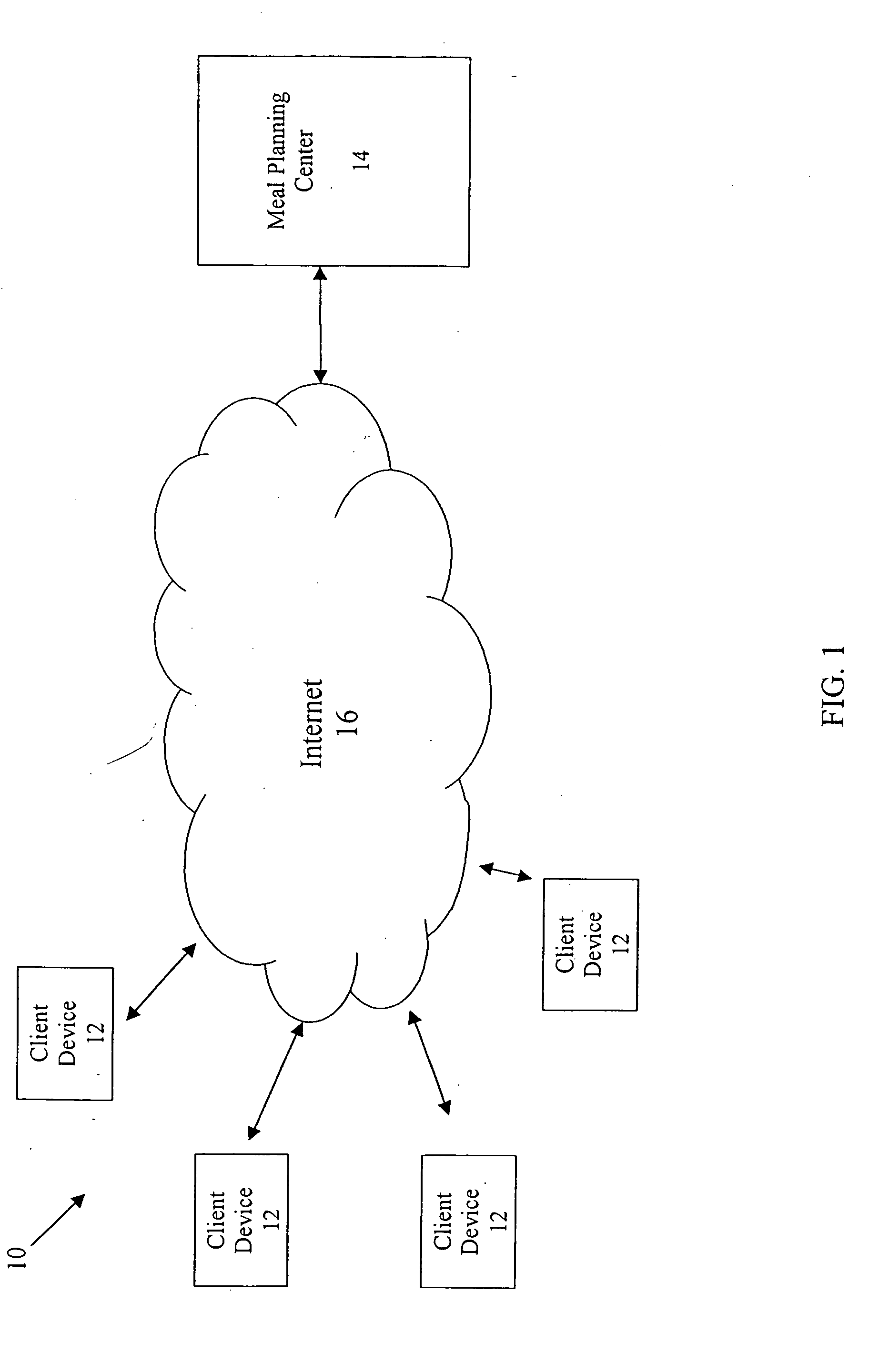

System and method for generating personalized meal plans

InactiveUS6872077B2Reduces knowledgeReduce effortNutrition controlComputer-assisted diets prescription/deliveryPersonalizationAdditive ingredient

A system for personalized meal planning is provided which includes a client device and a meal planning center configured to communicate with the client device and to receive a customer's information, including a weight designator, a gender designator, a goal designator, and an activity level designator. The meal planning center includes a storage device and a processing unit. The storage device is configured to store recipe template files having an ingredient designator and a plurality of recipe rule factors, which include a nutrient contribution value, a minimum ingredient value, and a maximum ingredient value. A plurality of recipe rule factors are each assigned to each ingredient designator. The processing unit is configured to determine a nutritional allowance based upon the customer information and to create a recipe that satisfies the nutritional allowance by using the recipe rule factors assigned to the ingredient. The meal planning center is further configured to transmit the recipe to the client device.

Owner:SOLOS HEALTH

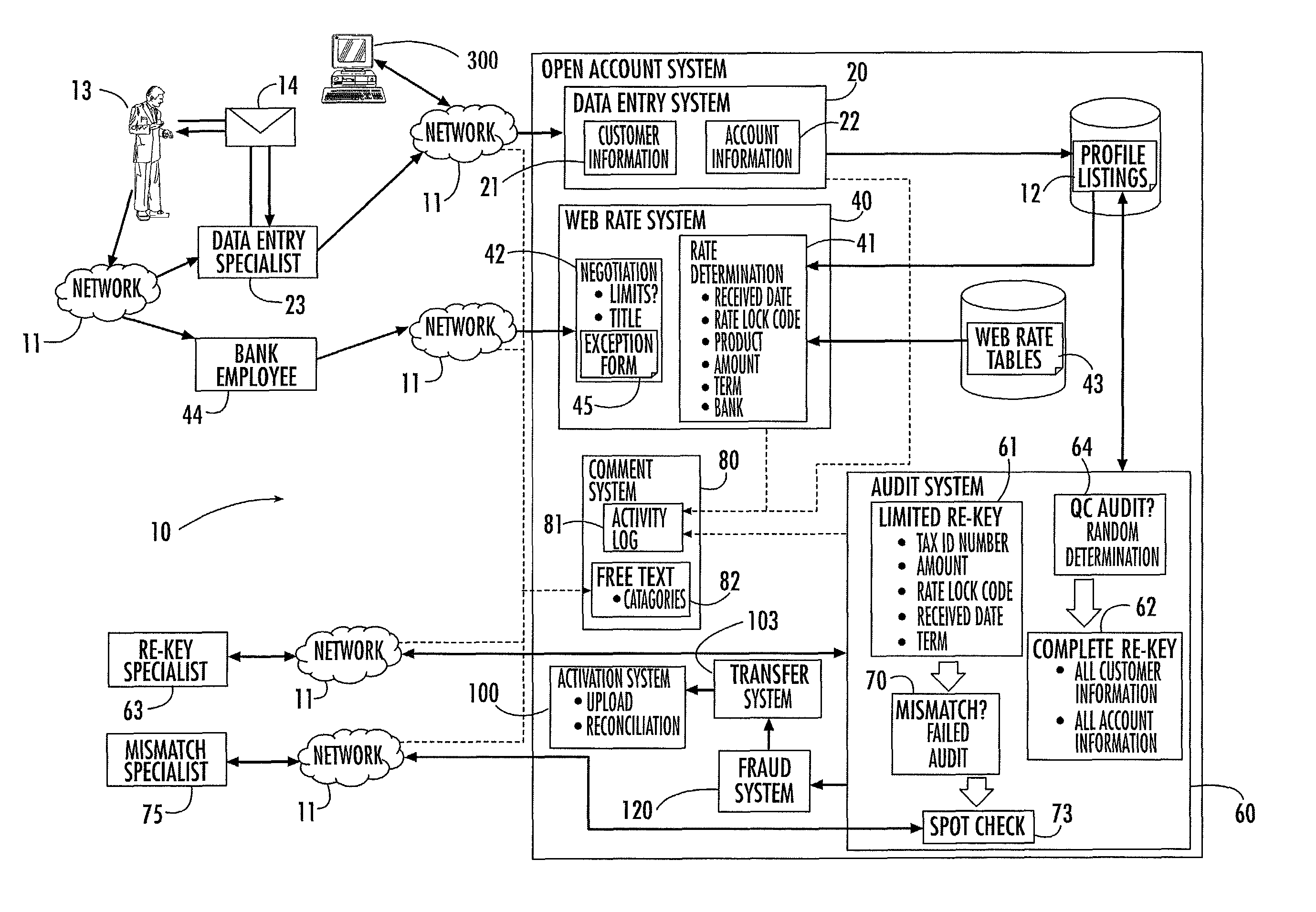

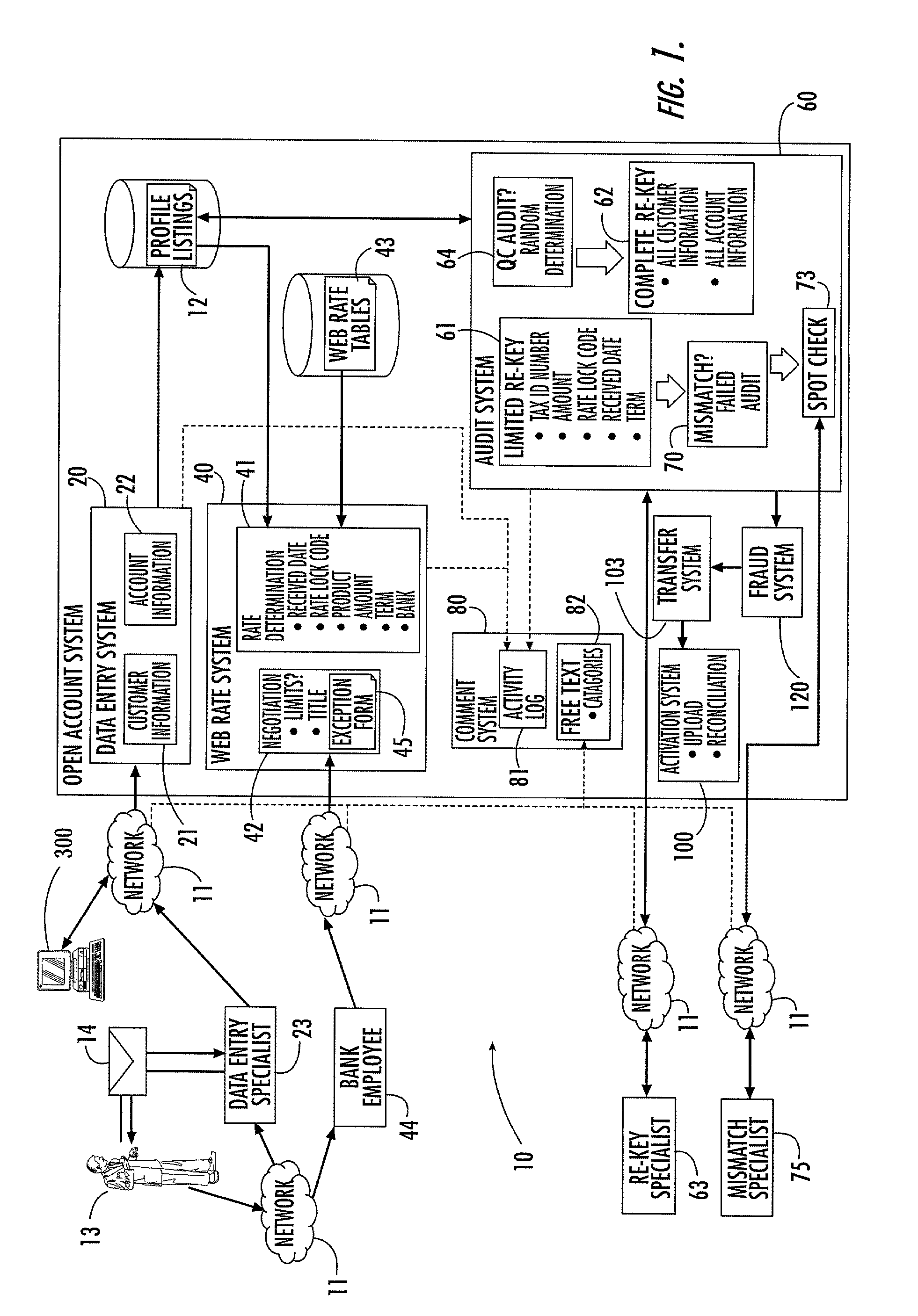

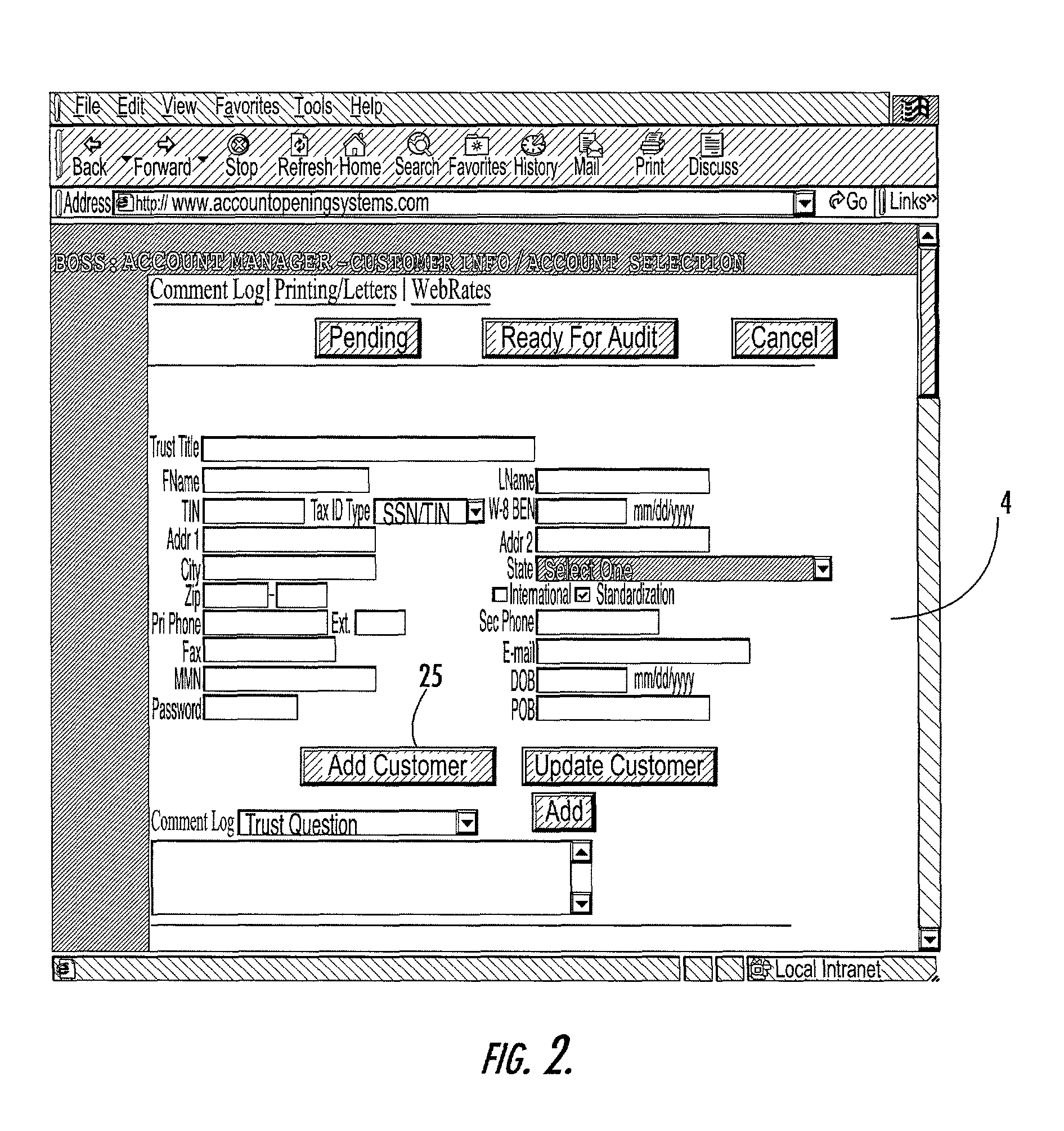

Account opening system, method and computer program product

ActiveUS8224723B2Improve accuracyImprove efficiencyFinancePayment architectureFile allocationBank account

A system that facilitates opening of a bank account by banking personnel for a customer. The account opening system includes an automatic rate determination feature that uses customer information, account information and other criteria to determine an account interest rate. The rate determination system may also mediate rate negotiation between a personal banker and the customer by limiting the increase in rate awarded by the personal banker. An auditing system assigns numbers to a series of profiles, each describing a request to open an account. Profiles to be audited are determined by generating random numbers that fall within the range of assigned profile numbers. Random number generation is repeated until a threshold percentage of profiles have been selected for auditing. The account opening system includes a system for tracking the progress of the account application and for organizing information recorded by the personal banker during interactions with the customer.

Owner:JPMORGAN CHASE BANK NA +1

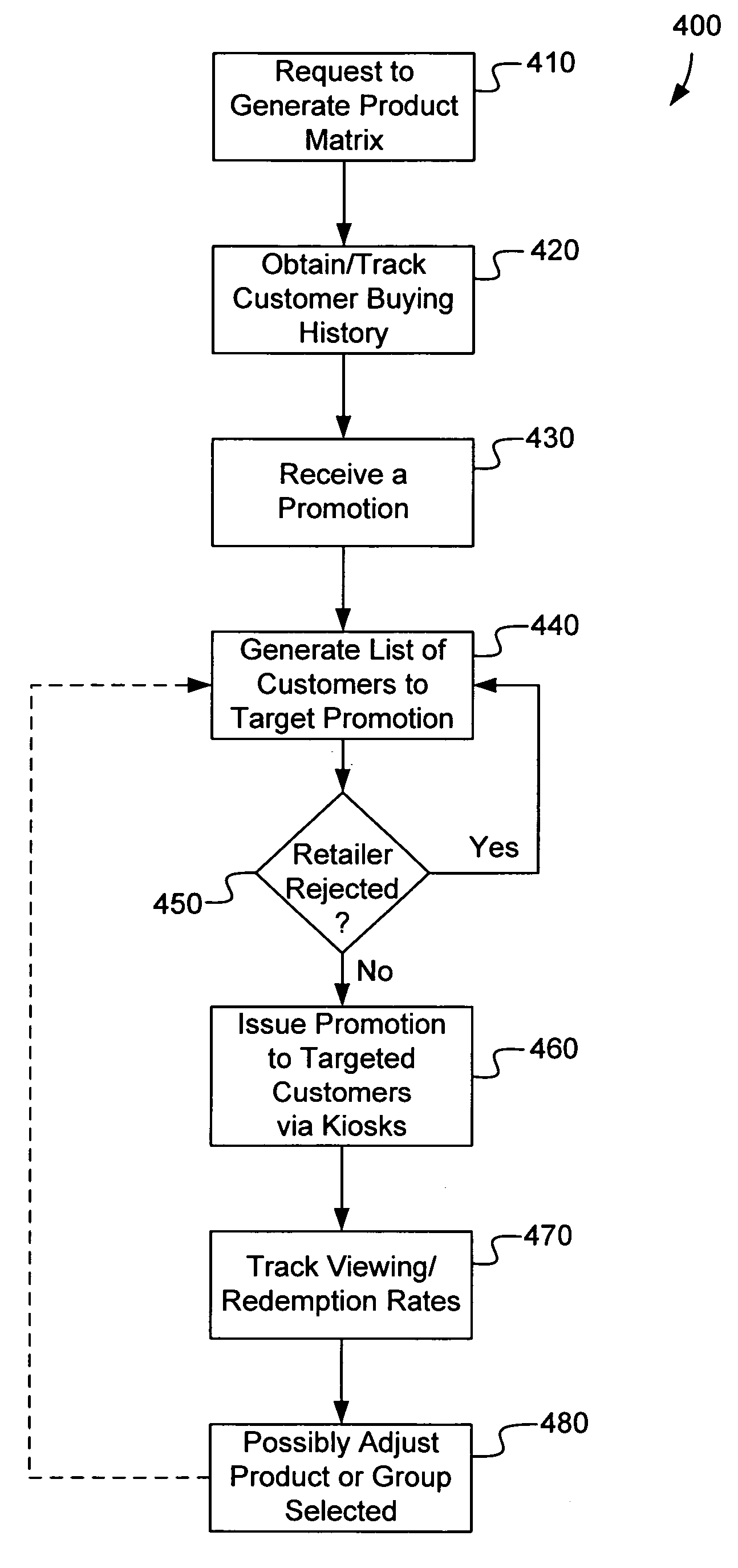

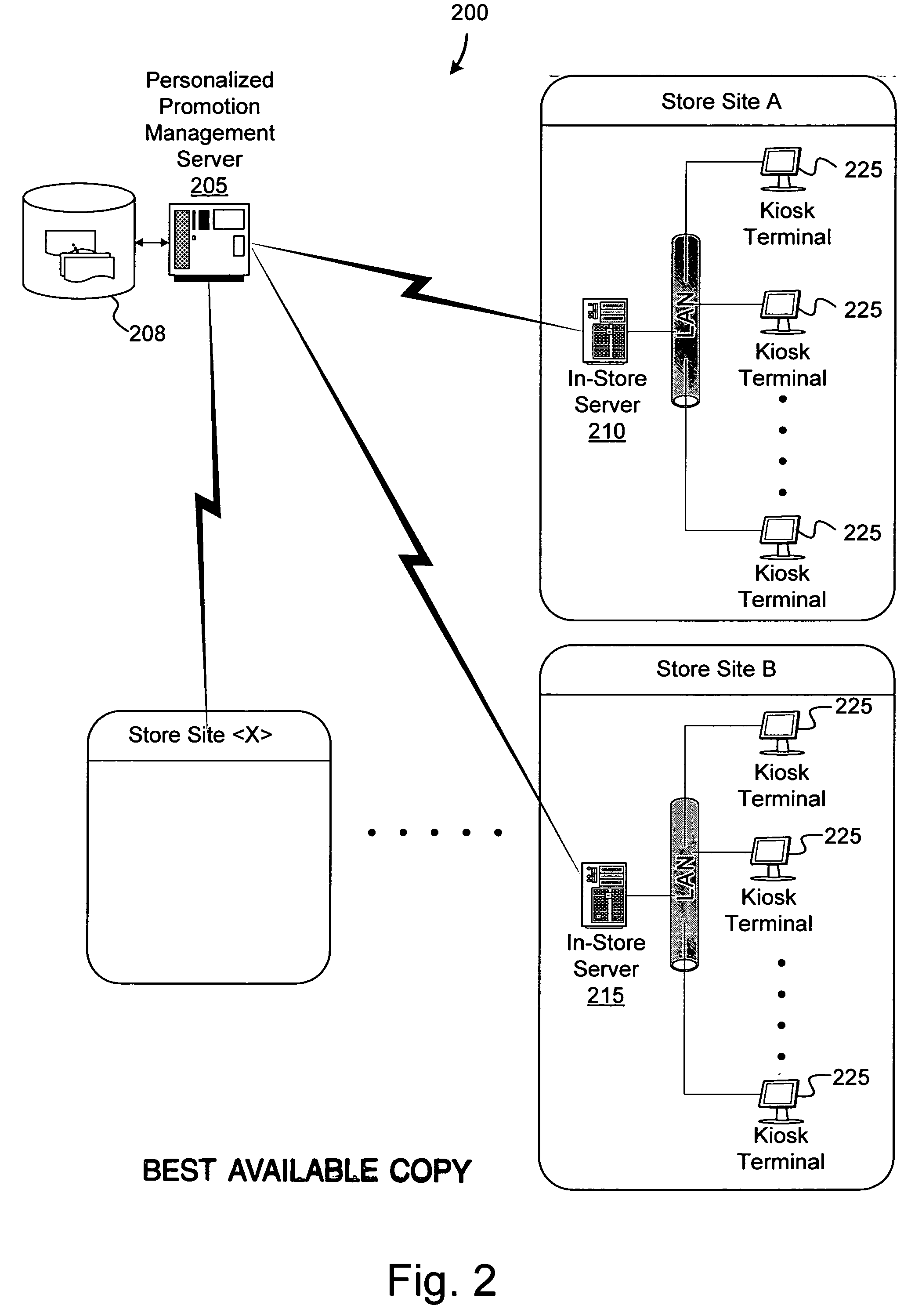

Systems and methods for personalized product promotion

InactiveUS20060277103A1Expand the marketPromote increaseAdvertisementsPersonalizationCustomer information

Embodiments generally relate to systems and methods for personalized product promotion and pricing. More specifically, embodiments relate to systems and methods for providing customized retail customer treatment through the use of personalized promotions, which may include personalized coupons, rewards, deals, and the like. In some embodiments, the retailers' customers are assigned unique accounts. One or more promotions may be offered to selected customers based on customer information. Customer information can be obtained from customer activity which is monitored through the use of the unique account assigned to the customer. Personalized product promotion systems and methods enable a retailer to target individual users uniquely and allow for each customer to take advantage of customized promotions based on his / her activities.

Owner:MAGEE

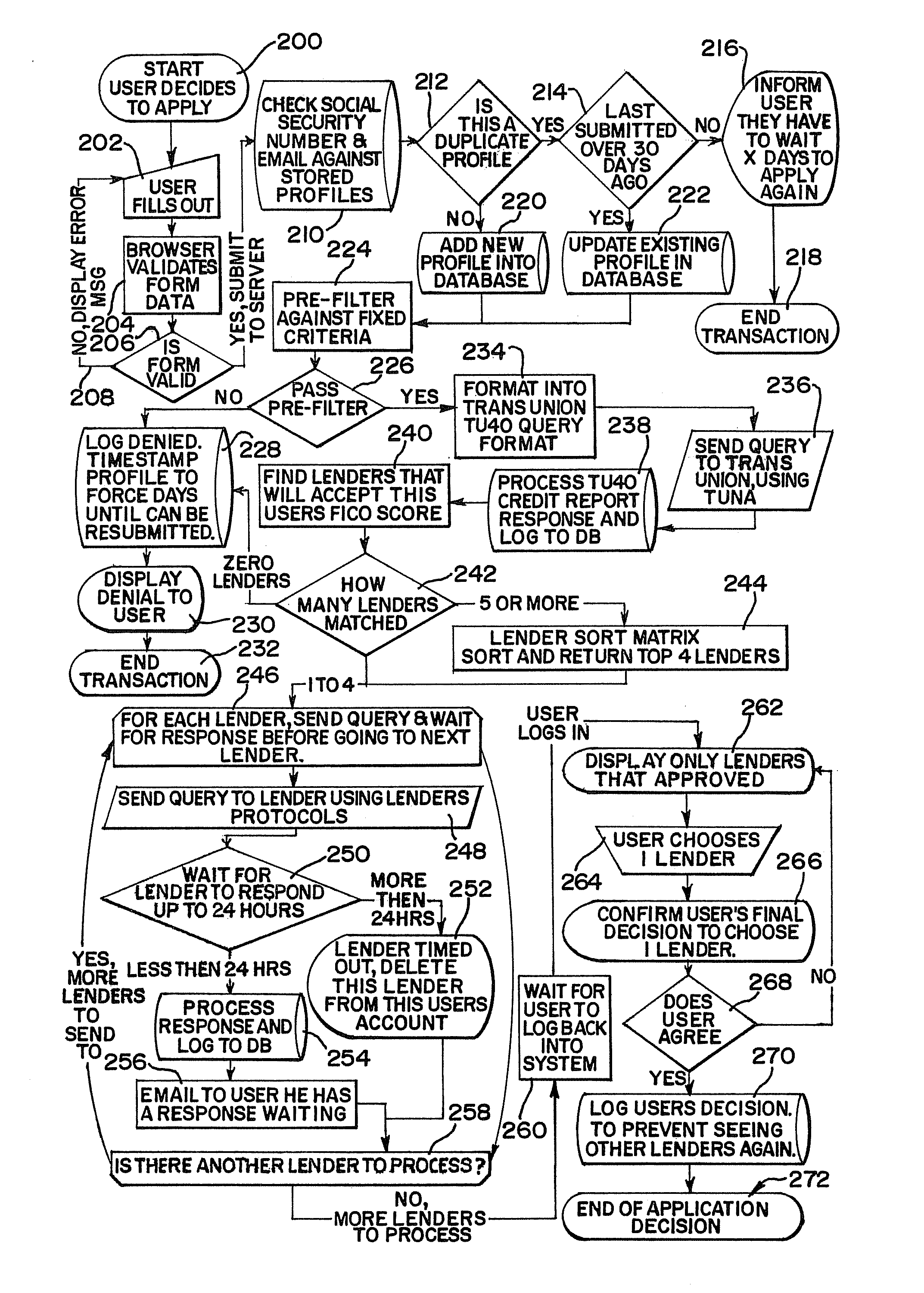

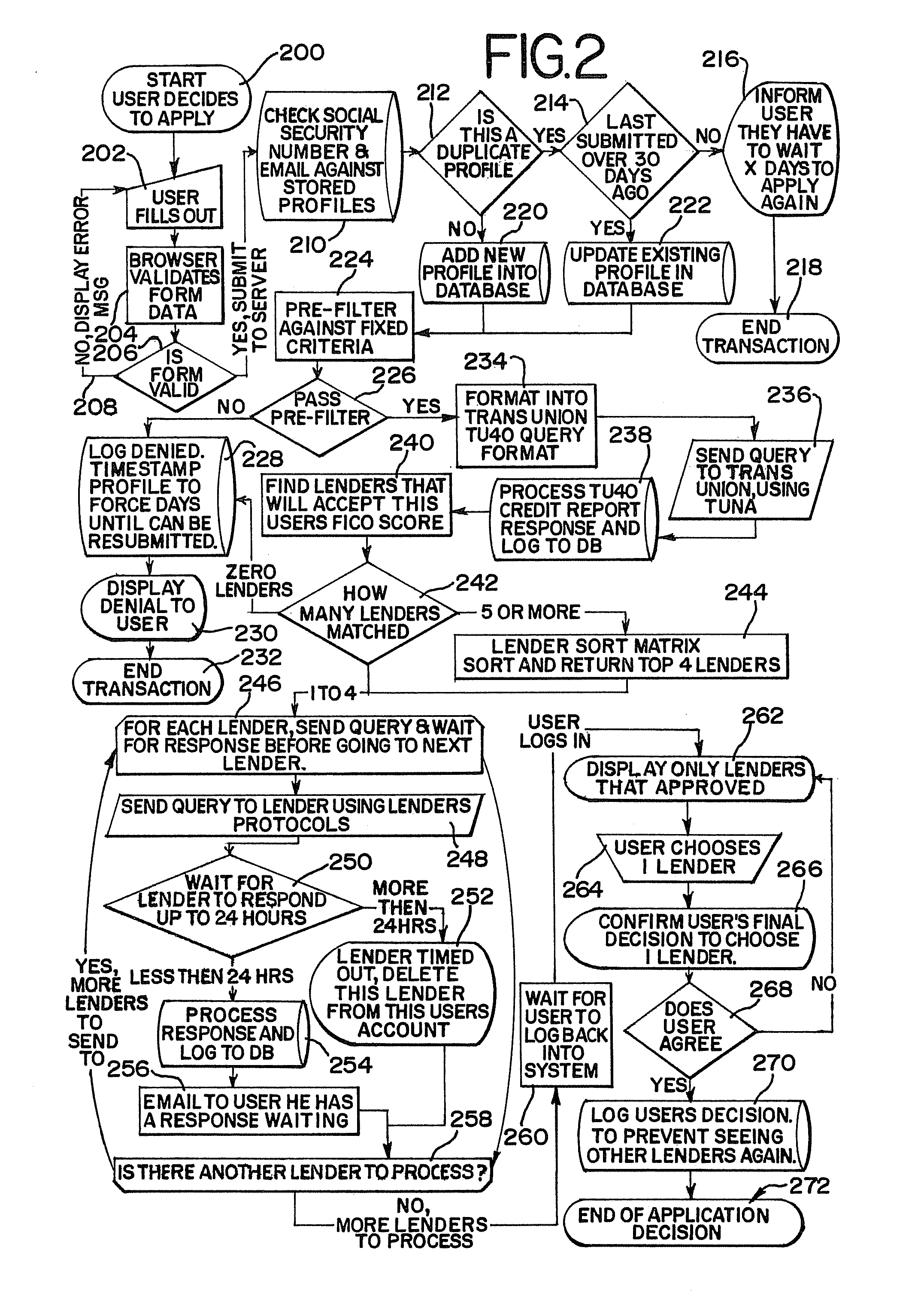

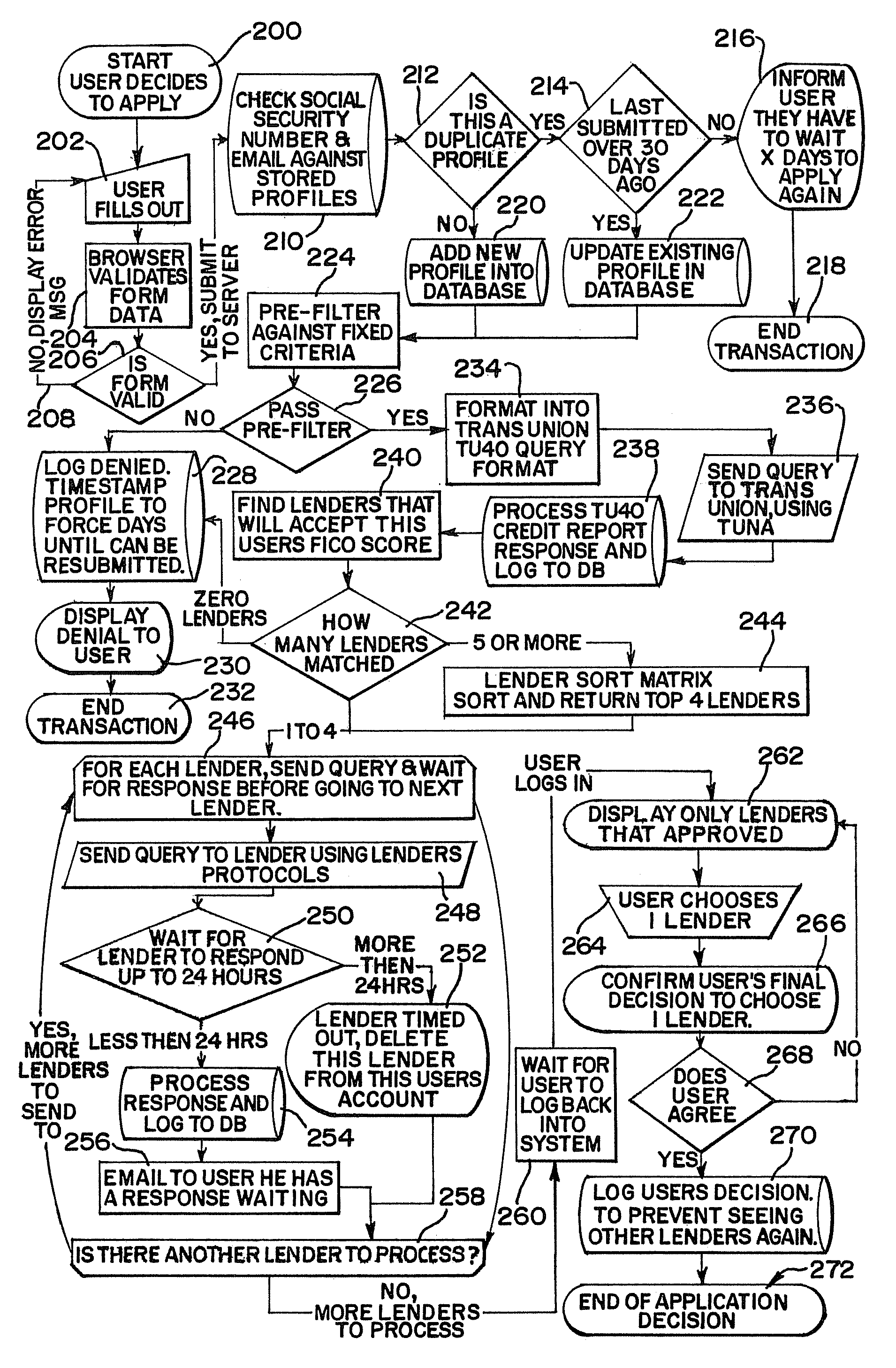

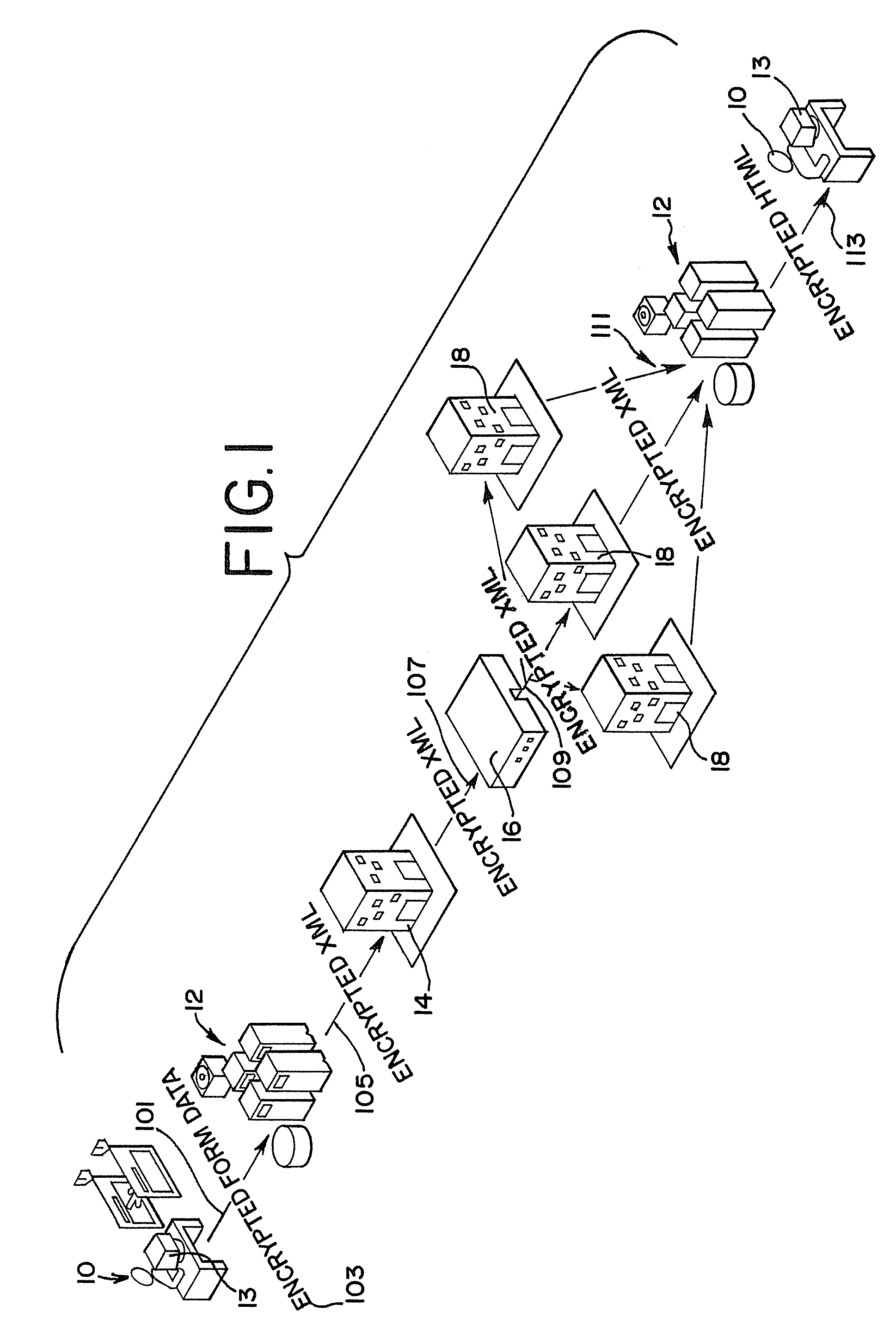

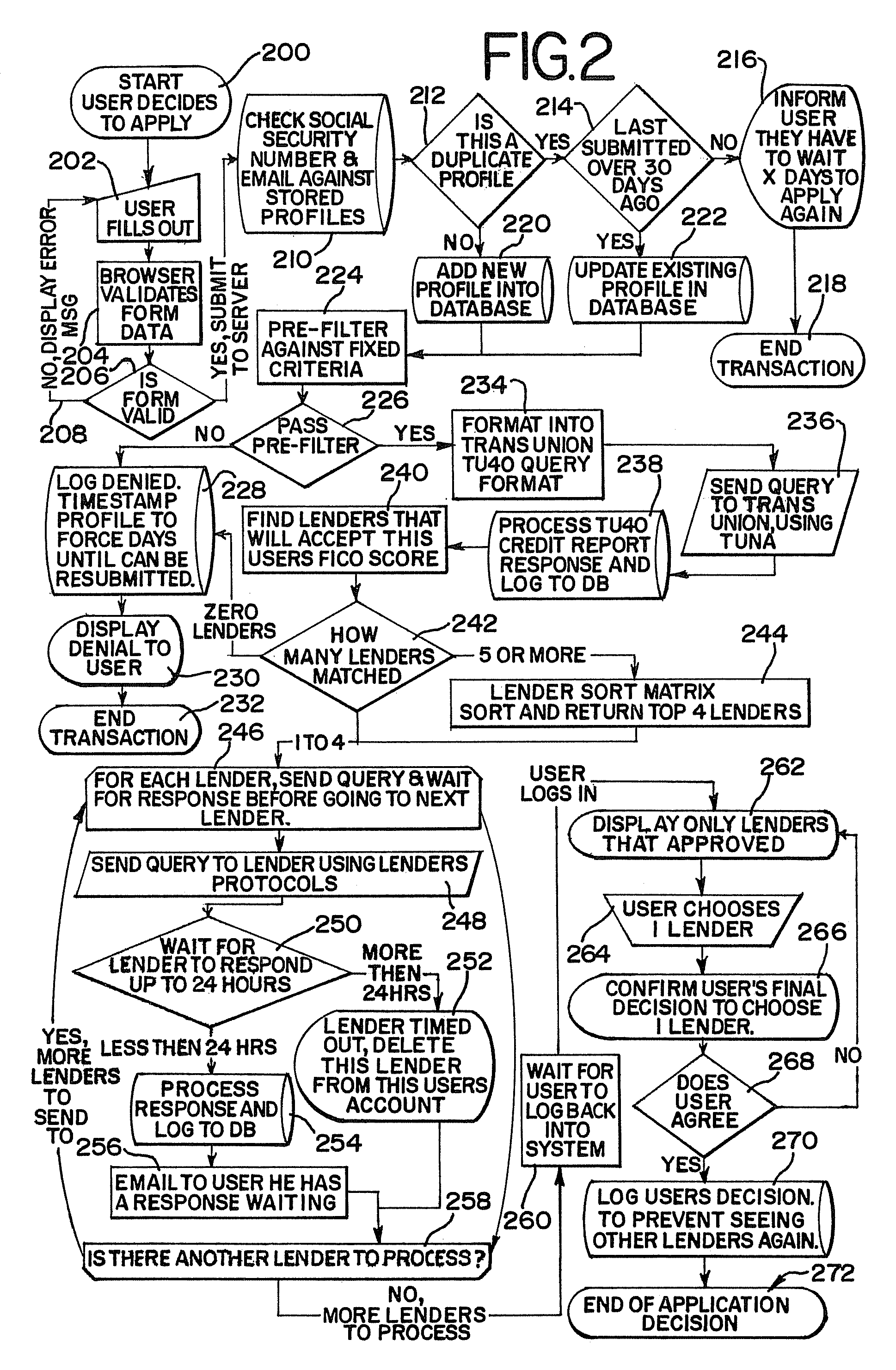

System and method for matching loan consumers and lenders

A system and method for matching a loan consumer with lenders via the Internet includes receiving loan consumer application information. The application information is stored in a database. A filter is applied to the information to determine if the loan consumer meets a set of loan criteria. A subset of the information is submitted to a credit bureau. A credit report is generated based on the subset of information. A lender database is searched to match the customer information and credit report to ranked lenders. A query is transmitted to one of the lenders. A response is generated and received based on the query. Subsequent query and response steps are repeated only after receipt of the previous response, until all lenders have been queried. Only lenders who responded with an approval are presented for review by the customer.

Owner:HORIZON DIGITAL FINANCE

System and method for matching loan consumers and lenders

A system and method for matching a loan consumer with lenders via the Internet includes receiving loan consumer application information. The application information is stored in a database. An internally specified filter is applied to the information to determine if the loan consumer meets a set of loan criteria. A subset of the information is submitted to a credit bureau. A credit report is generated based on the subset of information. A lender database is searched to match the customer information and credit report to ranked lenders. A query is transmitted to one of the lenders. A response is generated and received based on the query. Subsequent query and response steps are repeated only after receipt of the previous response, until all lenders have been queried. Only lenders who responded with an approval are presented for review by the customer.

Owner:HORIZON DIGITAL FINANCE

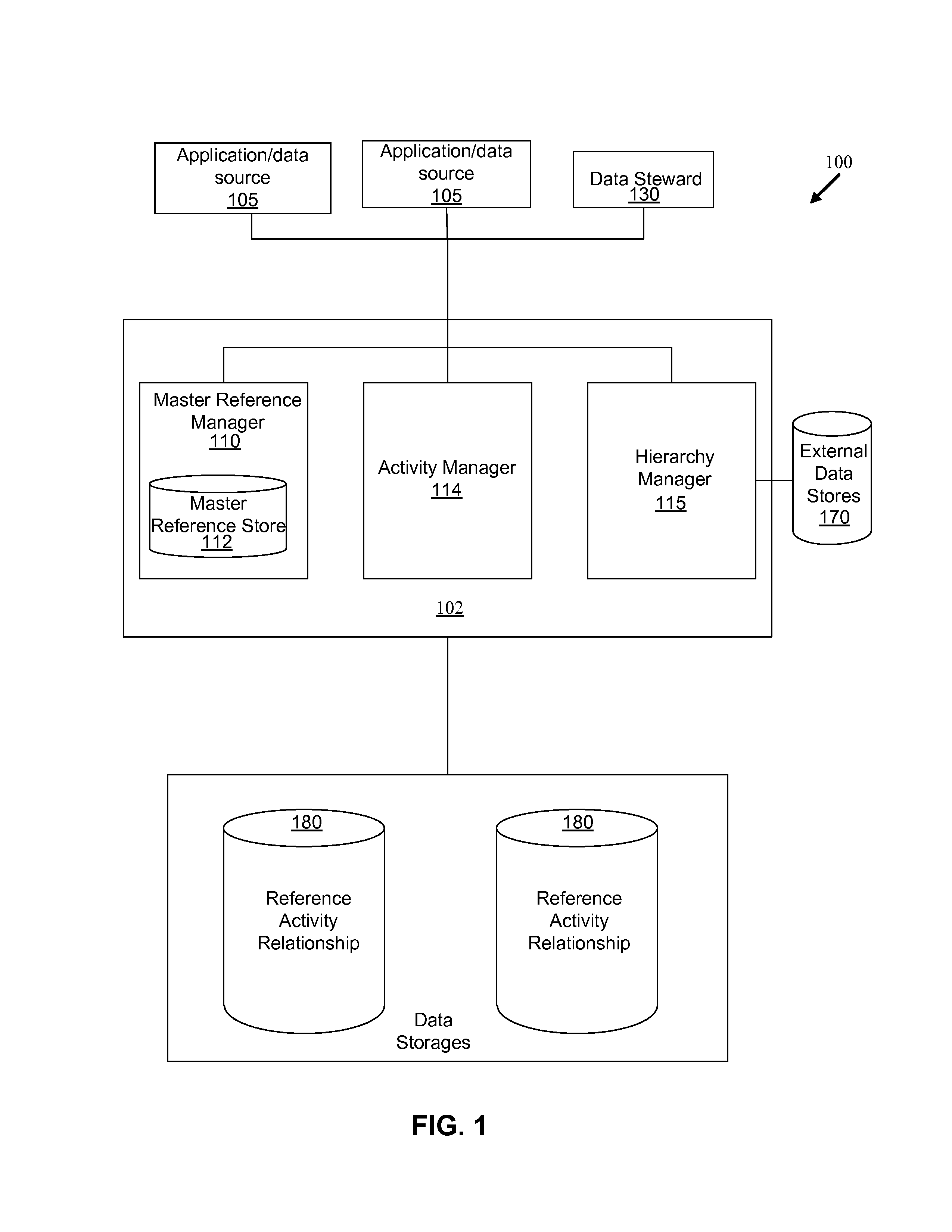

Shared view of customers across business support systems (BSS) and a service delivery platform (SDP)

ActiveUS20090112875A1Overcome deficienciesDigital data processing detailsDatabase distribution/replicationData aggregatorCustomer information

An identity management tool provides identity management across multiple domains, providing a single access point not only for information for runtime, network, and service layer information, but also for systems such as business support systems (BSS), operational support systems (OSS), and third party systems. The identity management tool creates a unified user profile that maps customer identities across the various domains, and presents the information in a virtual directory wherein the information appears to come from a single source, creating a central data hub for the various systems. This aggregation provides for the same experience and service across various access networks and using various channels. Such an architecture allows billing and service information to be shared with subscription and customer information, even though the data is substantially unrelated data from disparate data sources, without the need to combine schemas or aggregate the data into a single data store.

Owner:ORACLE INT CORP

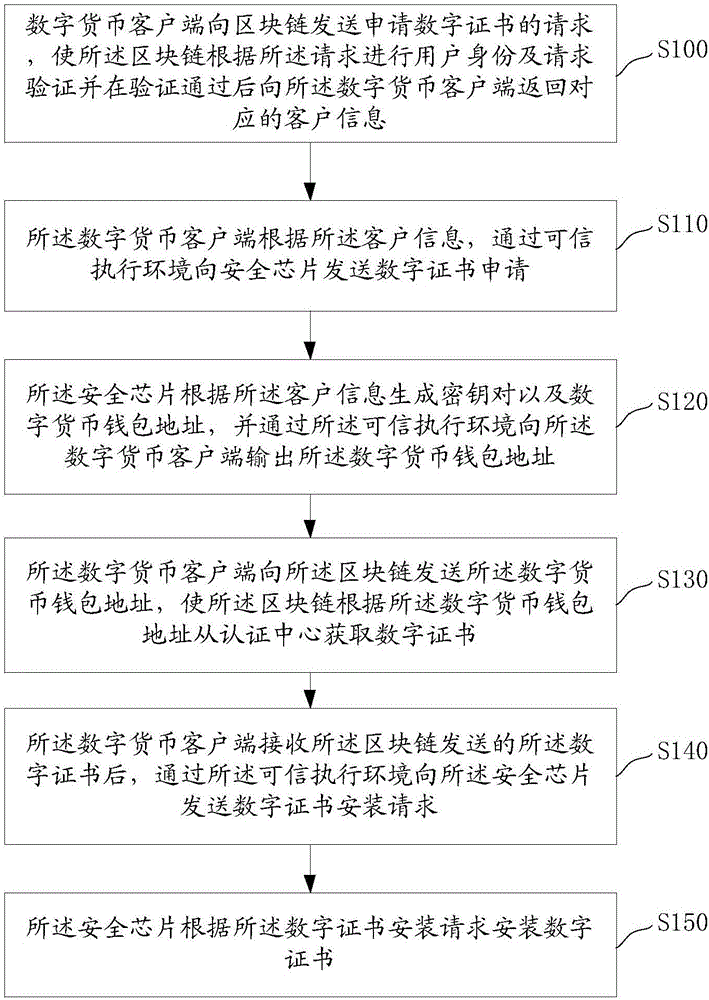

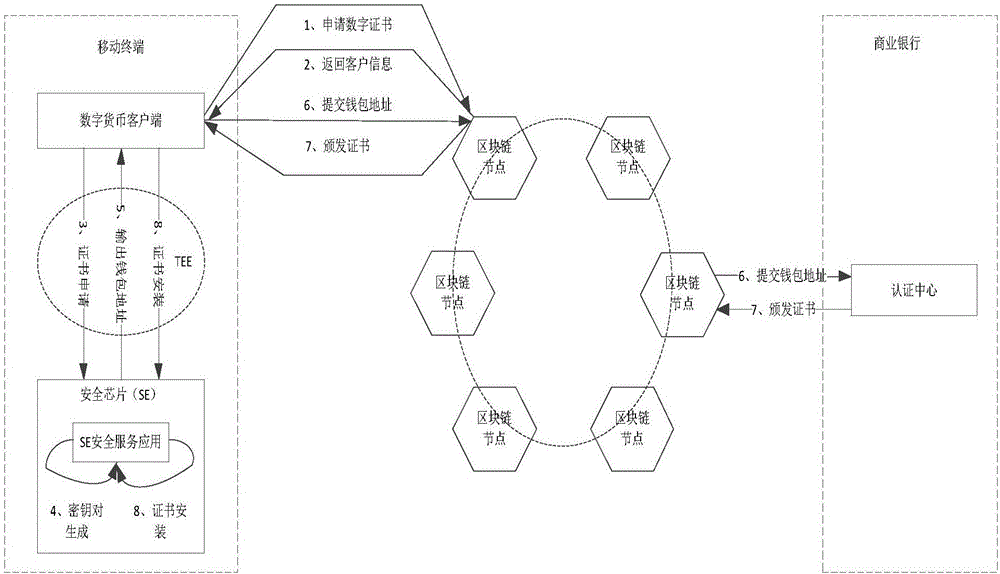

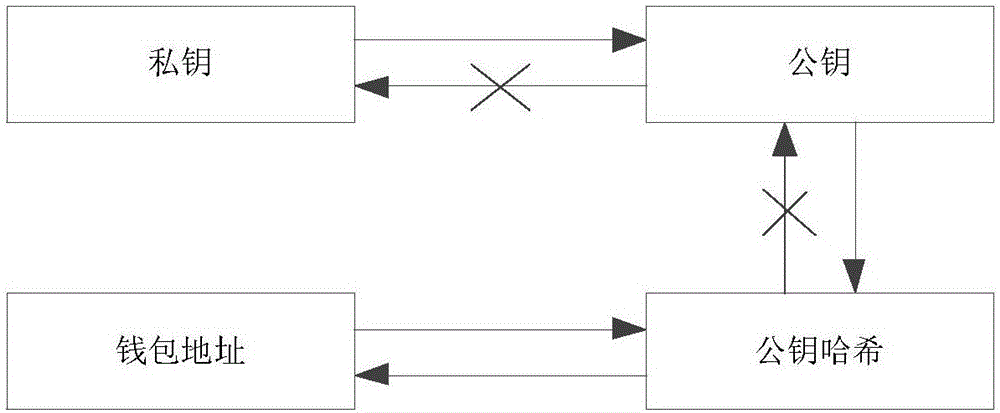

Method and system for using digital currency based on block chain as well as terminal

ActiveCN106850200AWith security encryption functionImprove securityKey distribution for secure communicationPublic key for secure communicationDigital currencyComputer terminal

The invention discloses a method and system for using digital currencies based on a block chain as well as a terminal. The method comprises the following steps: a digital currency client sends a request for applying a digital certificate to a block chain, and receives the corresponding customer information returned by the block chain after identity and request verification; a digital certificate application is sent to a security chip through a trusted execution environment according to the customer information; the security chip generates a key pair and a digital currency wallet address according to the customer information, and outputs the digital currency wallet address to the digital currency client through the trusted execution environment; the digital currency client sends the digital currency wallet address to the block chain to ensure that the block chain acquires the digital certificate from the authentication center according to the digital currency wallet address; and the digital currency client receives the digital certificate sent by the block chain, and sends a digital certificate installation request to the security chip through the trusted execution environment to ensure that the security chip is provided with the digital certificate. Thereby, the security of the block chain digital currency wallet can be increased through the security chip and the trusted execution environment.

Owner:中钞信用卡产业发展有限公司杭州区块链技术研究院 +1

System and method for generating personalized meal plans

InactiveUS20050287499A1Reduces knowledge and effortIncrease opportunitiesNutrition controlDiagnostic recording/measuringPersonalizationAdditive ingredient

Owner:SOLOS HEALTH

System for generating an advertising revenue projection

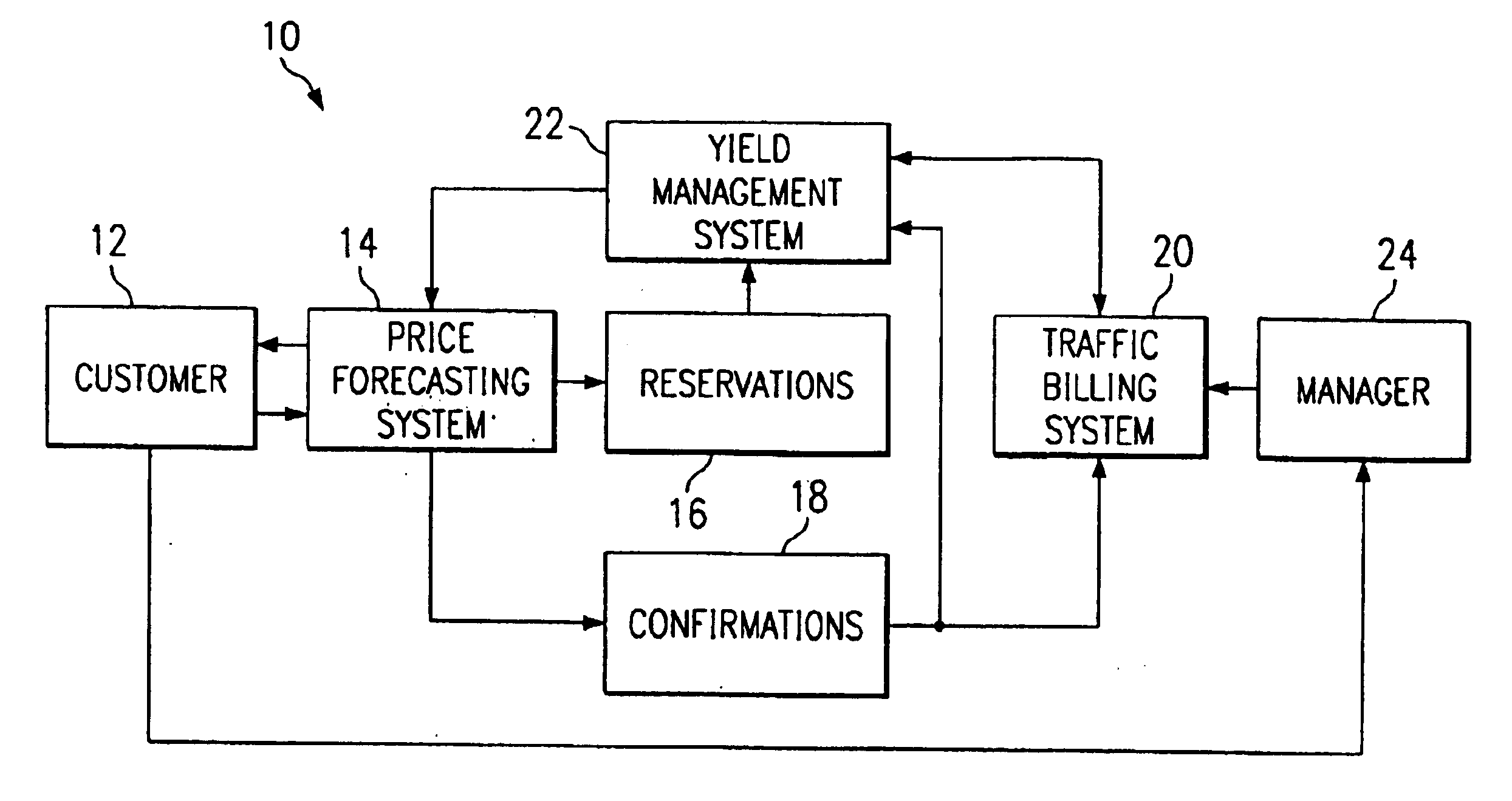

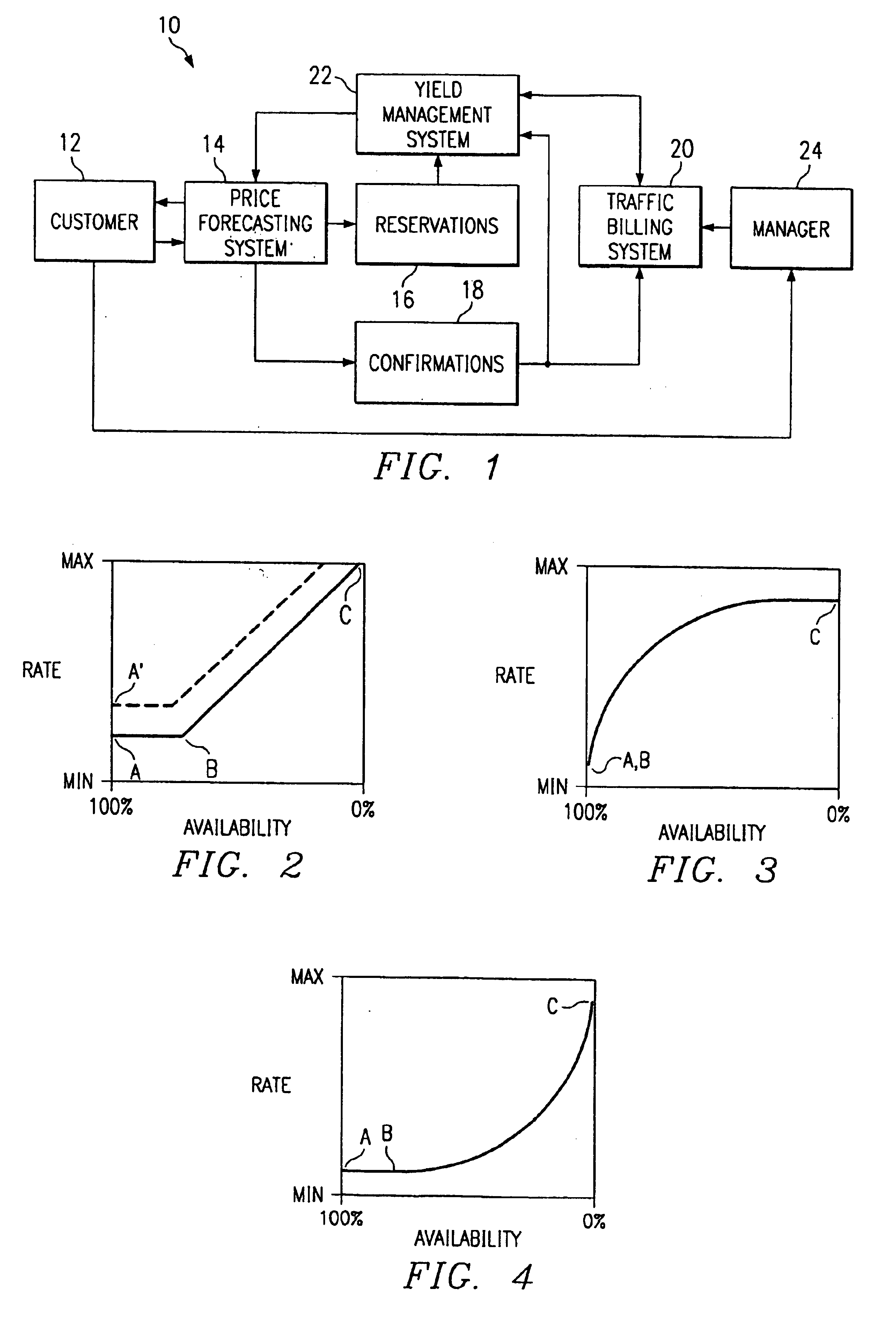

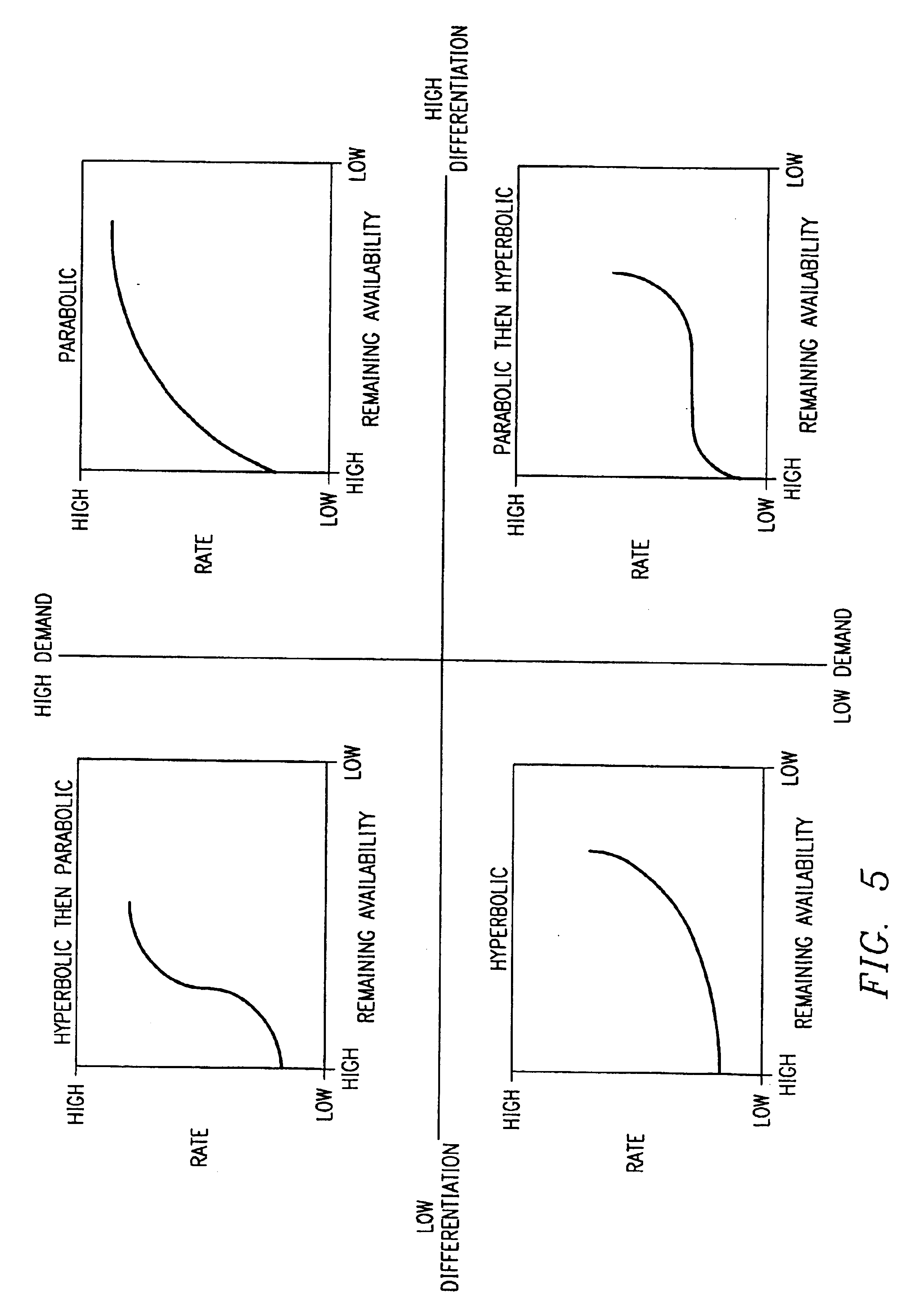

A method is provided for inventory management which includes an initial step of receiving a customer request for an inventory item and then generating a table or menu of one or more inventory items that most closely correspond to the customer request using a price forecasting system. Based on negotiations concerning price, timing and other typical concerns, an item is selected from the table and a price quotation associated with the selected inventory item is generated using the price forecasting system, which price quotation has been predetermined by a yield management system using a pricing strategy. The customer information associated with the customer request is input into a traffic billing system. Information needed for price recalculation associated with the customer request is input into the yield management system. The yield management system recalculates pricing data with in a manner consistent with a pricing strategy implemented by the yield management system, so that price changes caused by a reduction in available inventory due to the customer request are taken into account, and the pricing data accessed by the price forecasting system when a price quotation is generated is updated prior to repeating the process for a subsequent customer request. This method provides more accurate pricing than known systems where order information must be entered manually before a price recalculation can take place, and the yield management system overestimates the amount of available inventory. If the customer request comprises a reservation having an associated probability of later becoming an order, the reservation is taken into account when recalculating prices based on available inventory. Such a process may be integrated for an enterprise made up of a number of member stations each having associated inventory for sale.

Owner:IHEARTMEDIA MANAGEMENT SERVICES

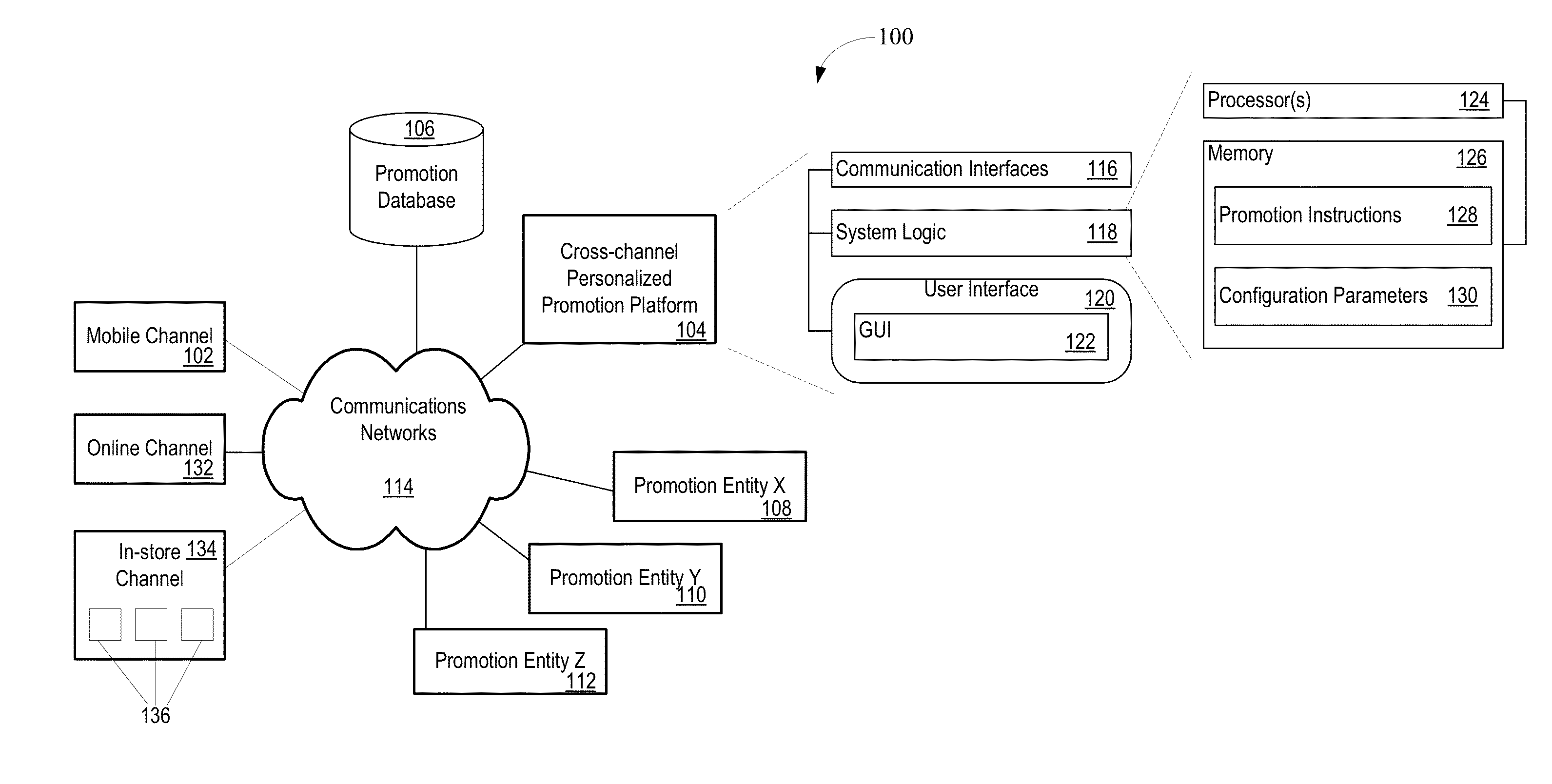

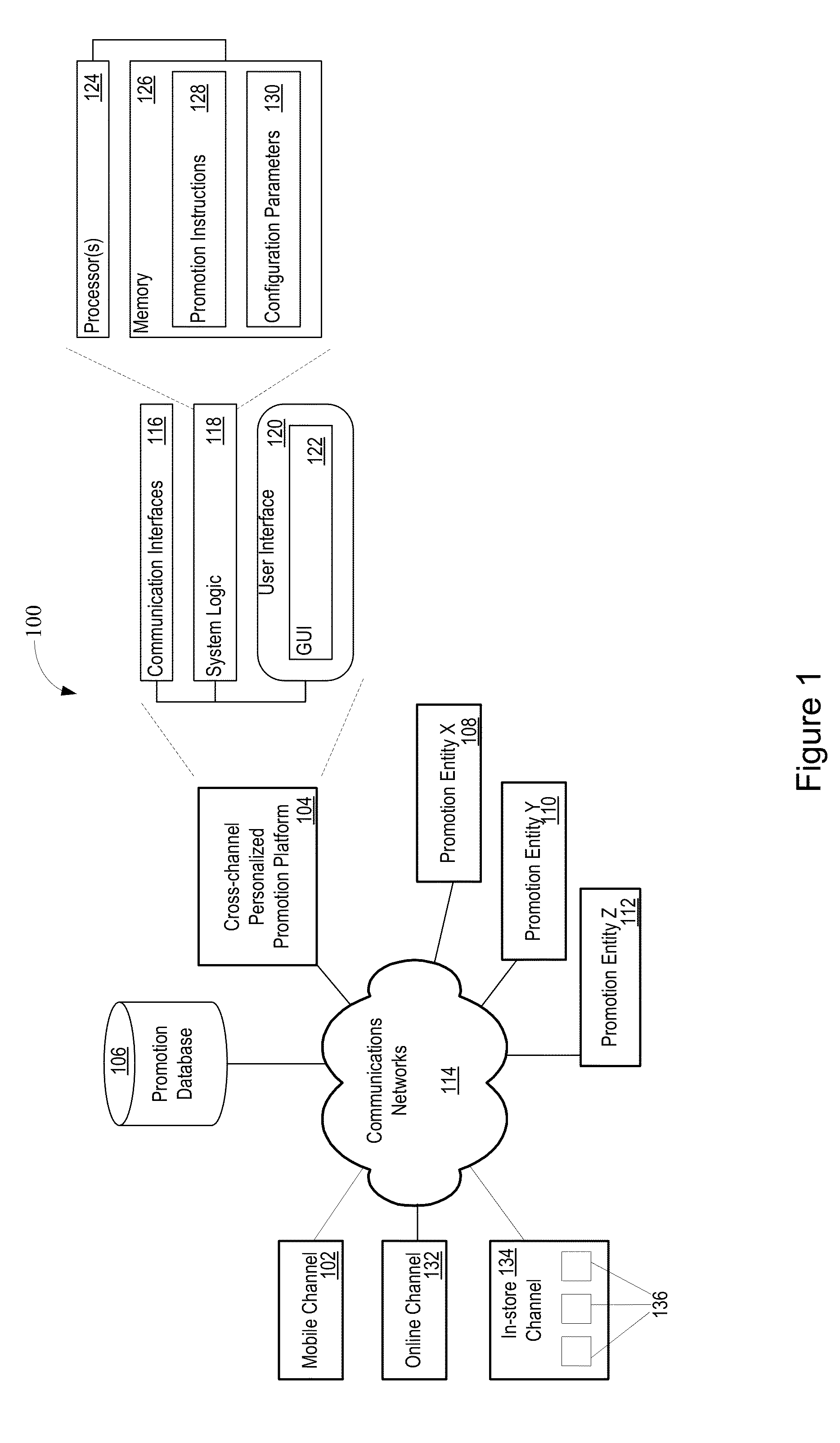

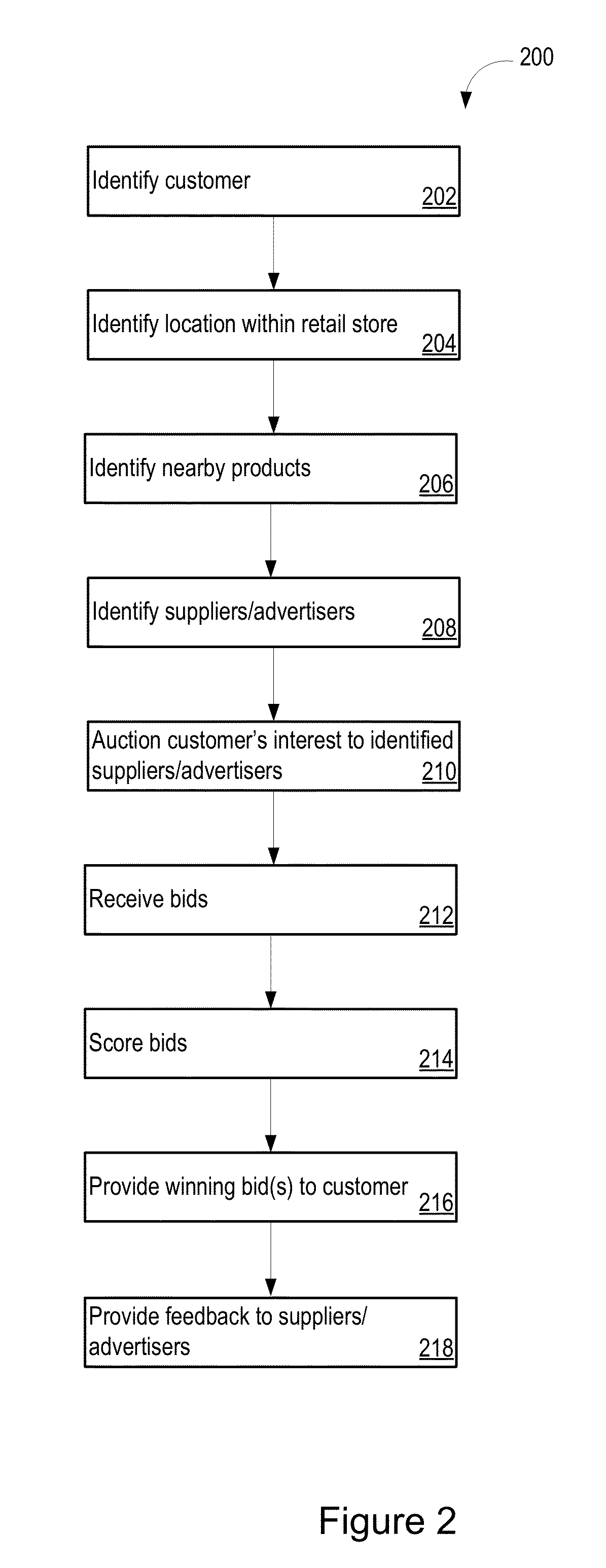

Cross-channel personalized promotion platform

A platform for providing real-time promotions determines a customer interested in a product or service. The platform identifies customer information associated with the customer, as well as a set of products of interest to the customer. The platform identifies a supplier or advertiser associated with each of the products and receives promotion bids from one or more of the suppliers or advertisers. The platform generates a score for each of the received promotion bids, selects at least one of the promotion bids for transmission to the mobile device, and transmits the selected at least one promotion bids to the mobile device. The platform tracks customer behavior associated with the at least one promotion bids and provides the tracked behavior information back to the suppliers or advertisers.

Owner:ACCENTURE GLOBAL SERVICES LTD

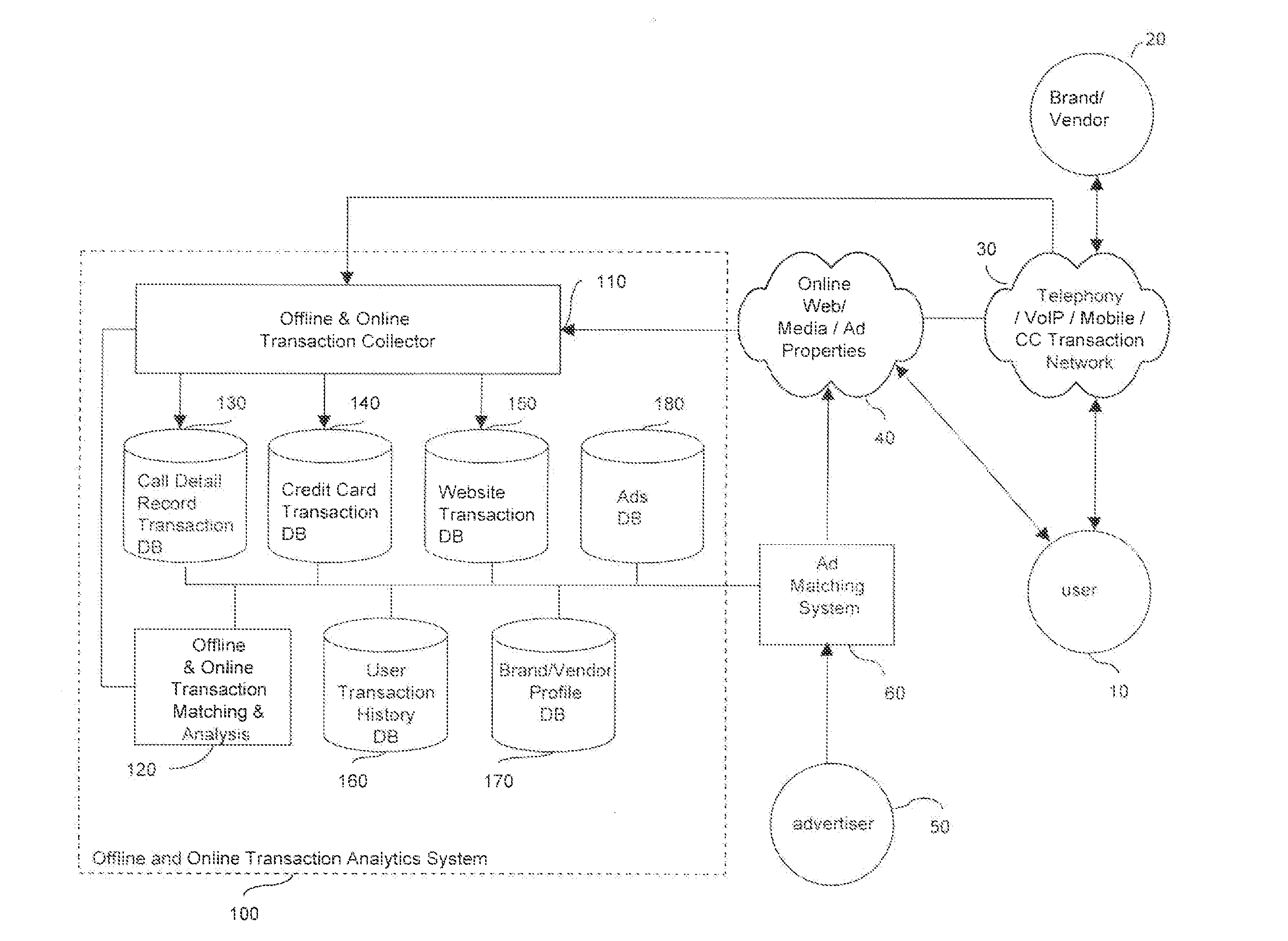

Method and System for Optimizing Advertising Conversion

A call and web-based analytics system that optimizes advertising conversion includes collection of call and web-based transaction information to establish digital entity based on customer transaction history. The collection of call and web-based data establishes buyer purchasing cycle scorecard that reflects the buyer's transactional history. Advertisers can search, match and / or bid for customers that meet the criteria based on both call and web-based transactional history. Ads are delivered based on customer buying cycle process stage to match the timing of purchase and buying cycle. Optimized response rates and sales conversions are achieved by targeting matched ads during the customer purchasing cycle stage based on matched customer transactional history and collected customer profile information.

Owner:MASHINSKY ALEX +1

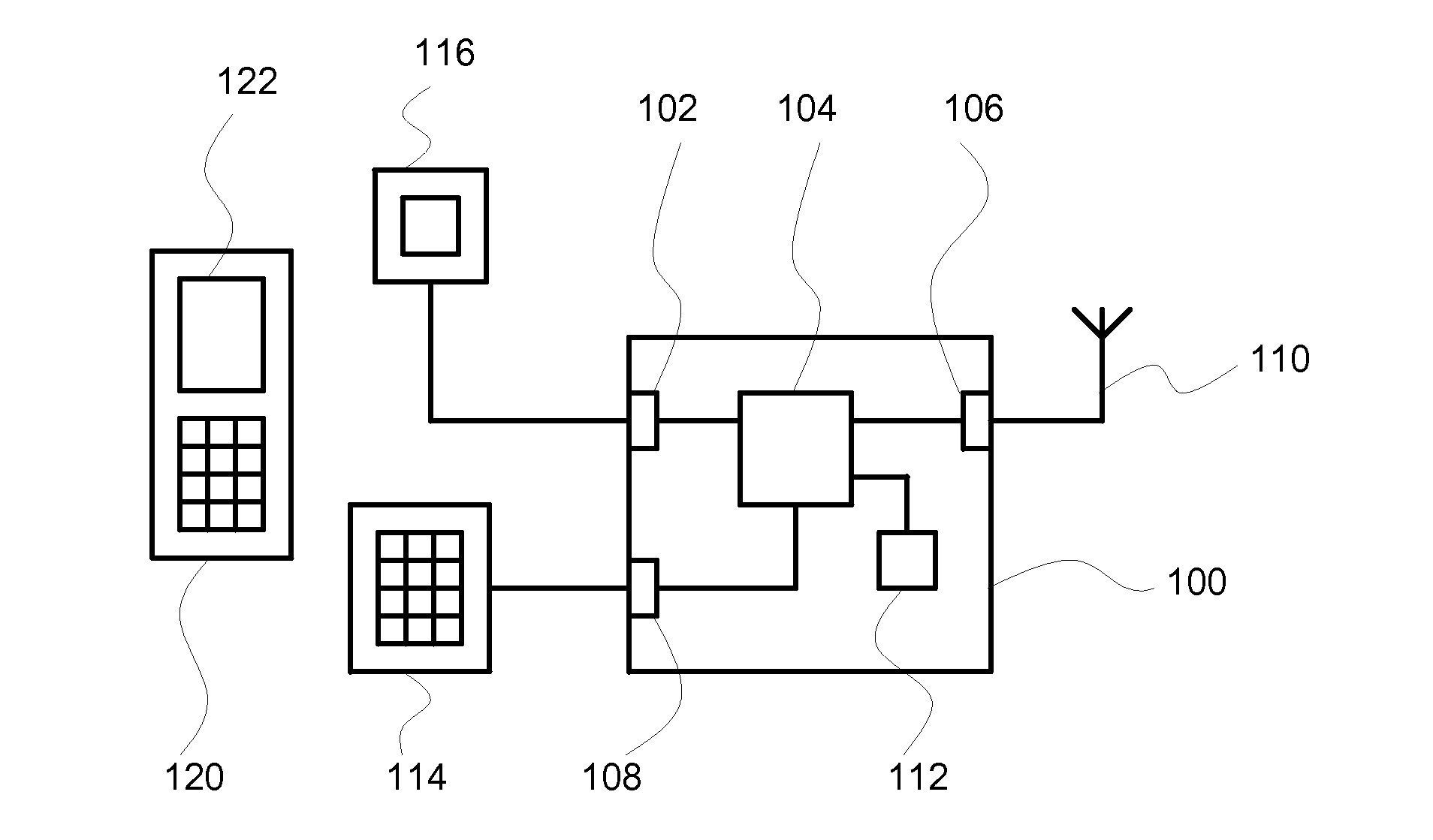

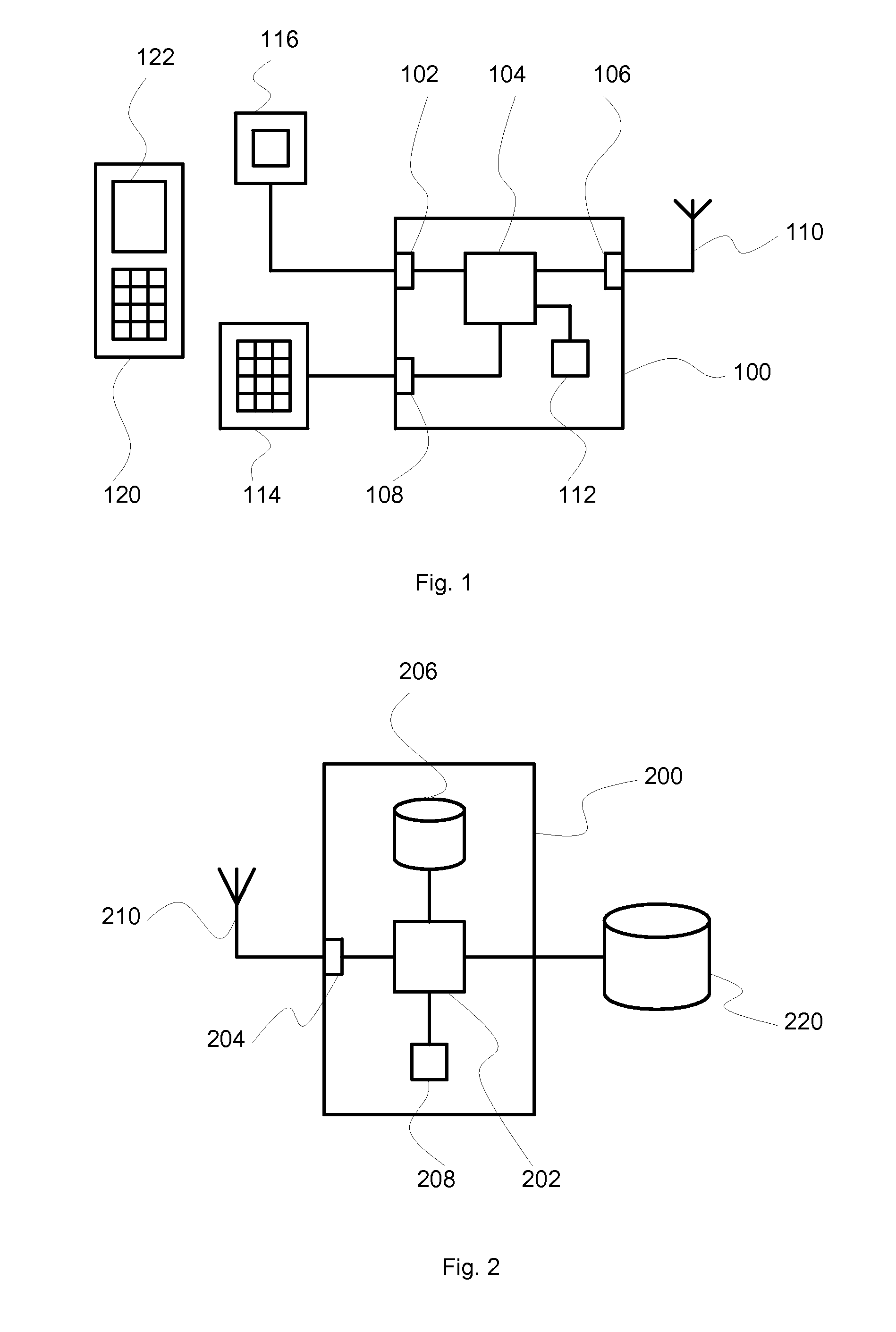

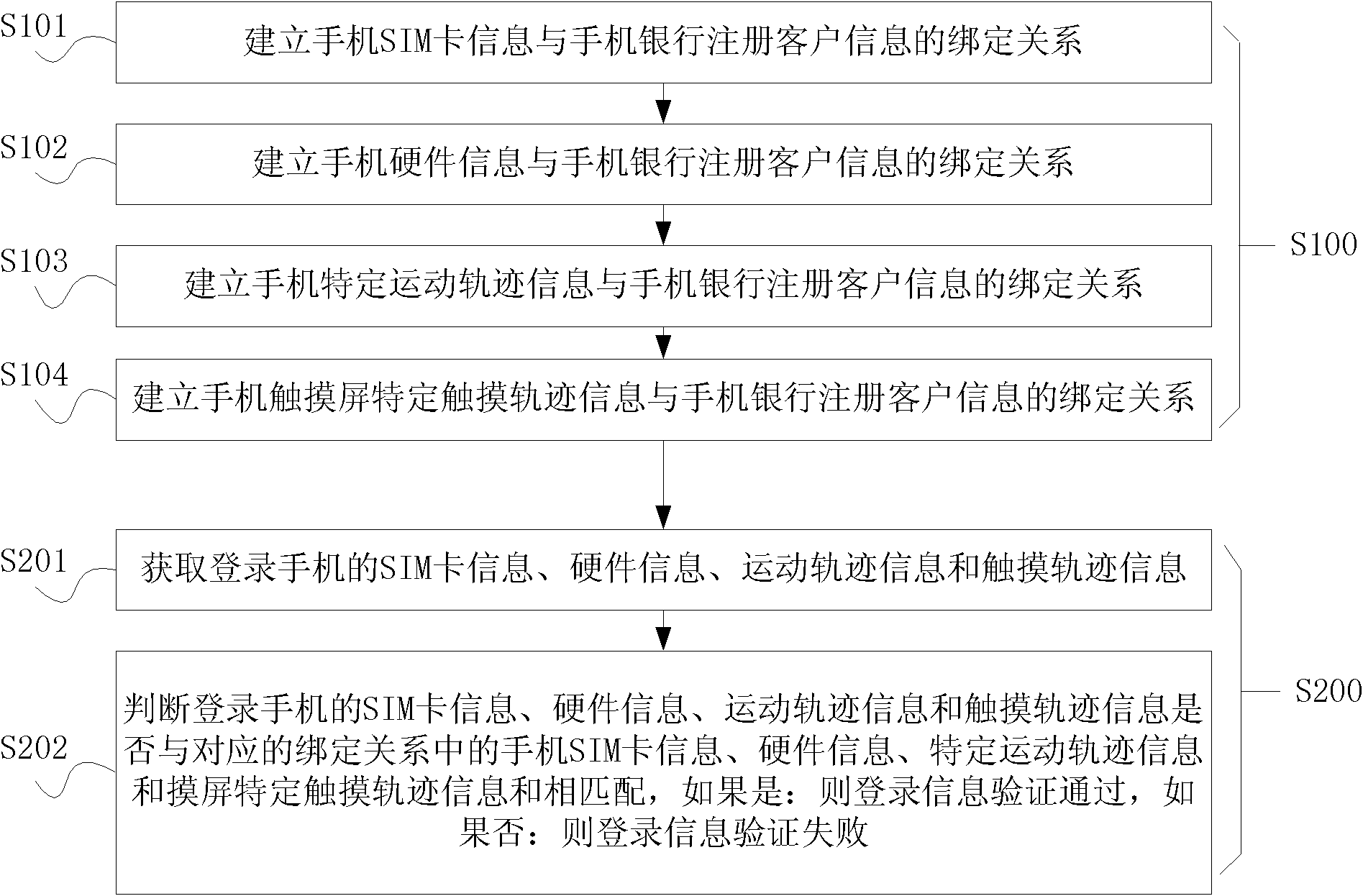

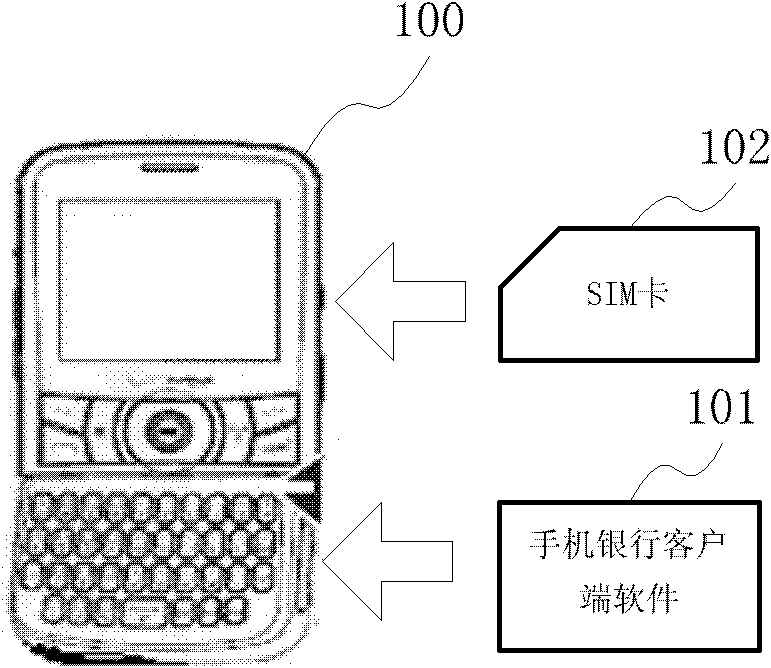

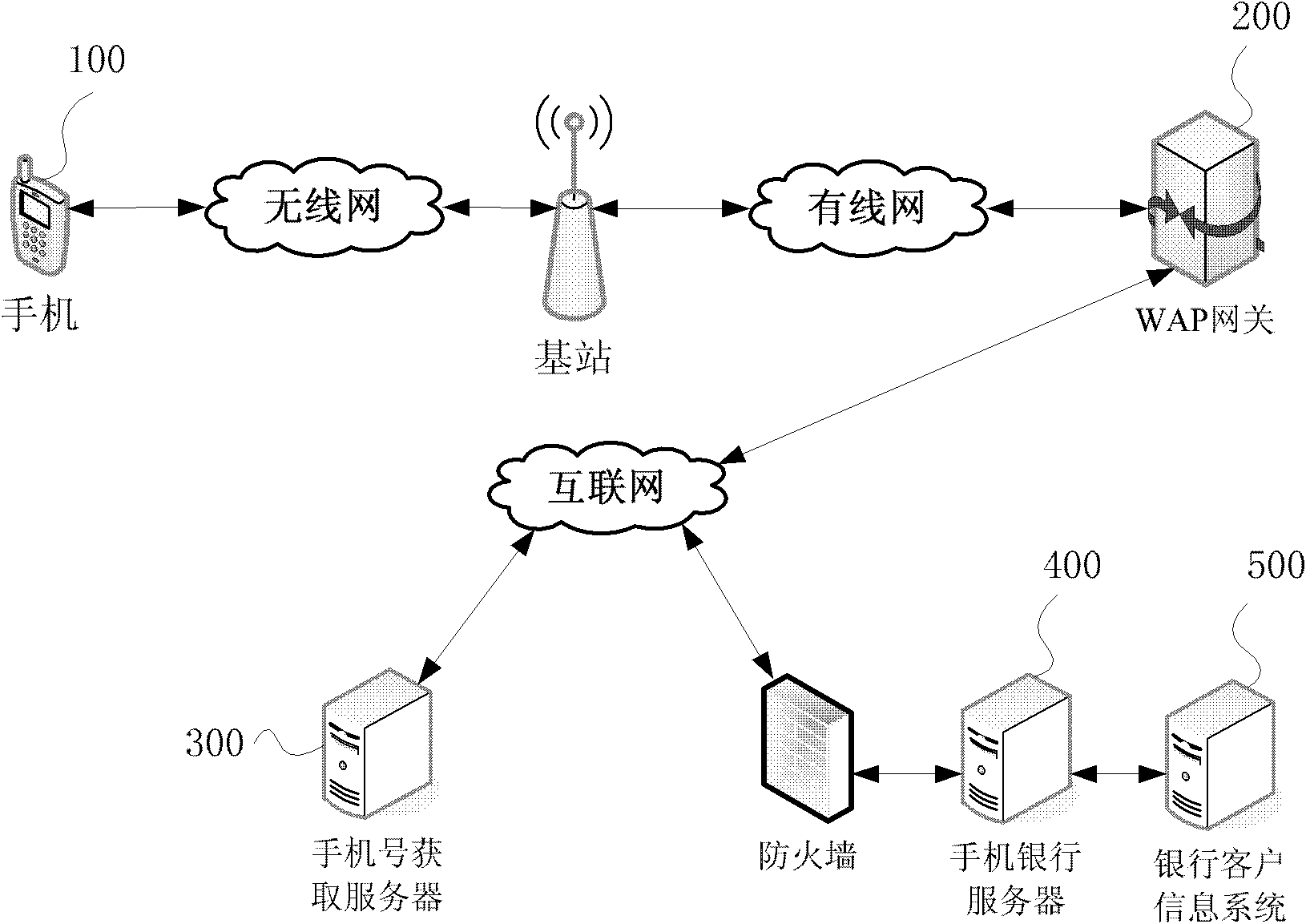

Method and system for authenticating mobile banking client information, and mobile terminal

ActiveCN102143482AImprove securityStrengthen security controlTransmissionSecurity arrangementCustomer informationClient-side

The embodiment of the invention provides a method and a system for authenticating mobile banking client information, and a mobile terminal. The method comprises a mobile banking customer information binding step and a mobile banking login information authenticating step, wherein the mobile banking customer information binding step comprises the following sub-steps of: establishing a binding relationship between mobile phone subscriber identity module (SIM) card information and mobile banking registered customer information, and establishing a binding relationship between mobile phone hardware information and the mobile banking registered customer information; and the mobile banking login information authenticating step comprises the following sub-steps of: acquiring the SIM card information and the hardware information of a login mobile phone, and judging whether the SIM card information and the hardware information of the login mobile phone are matched with the mobile phone SIM card information and the hardware information in the corresponding binding relationship, if so, passing the login information authentication, otherwise, failing to pass the login information authentication. The problem of security of mobile banking system information at the client is solved.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com