Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

416 results about "Online trading" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

In finance, an electronic trading platform also known as an online trading platform, is a computer software program that can be used to place orders for financial products over a network with a financial intermediary. Various financial products can be traded by the trading platform, over a communication network with a financial intermediary or directly between the participants or members of the trading platform. This includes products such as stocks, bonds, currencies, commodities, derivatives and others, with a financial intermediary, such as brokers, market makers, Investment banks or stock exchanges. Such platforms allow electronic trading to be carried out by users from any location and are in contrast to traditional floor trading using open outcry and telephone based trading. Sometimes the term trading platform is also used in reference to the trading software alone.

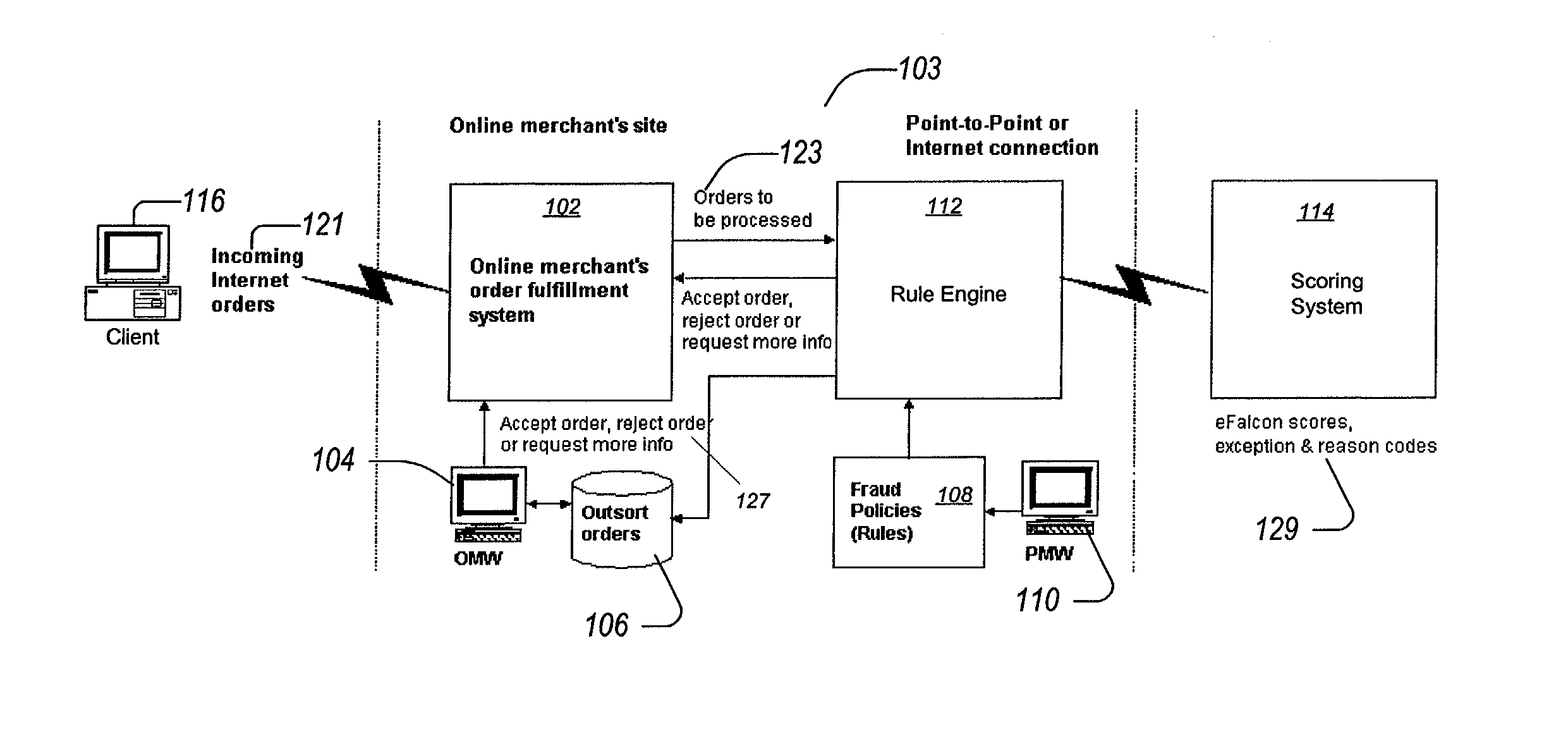

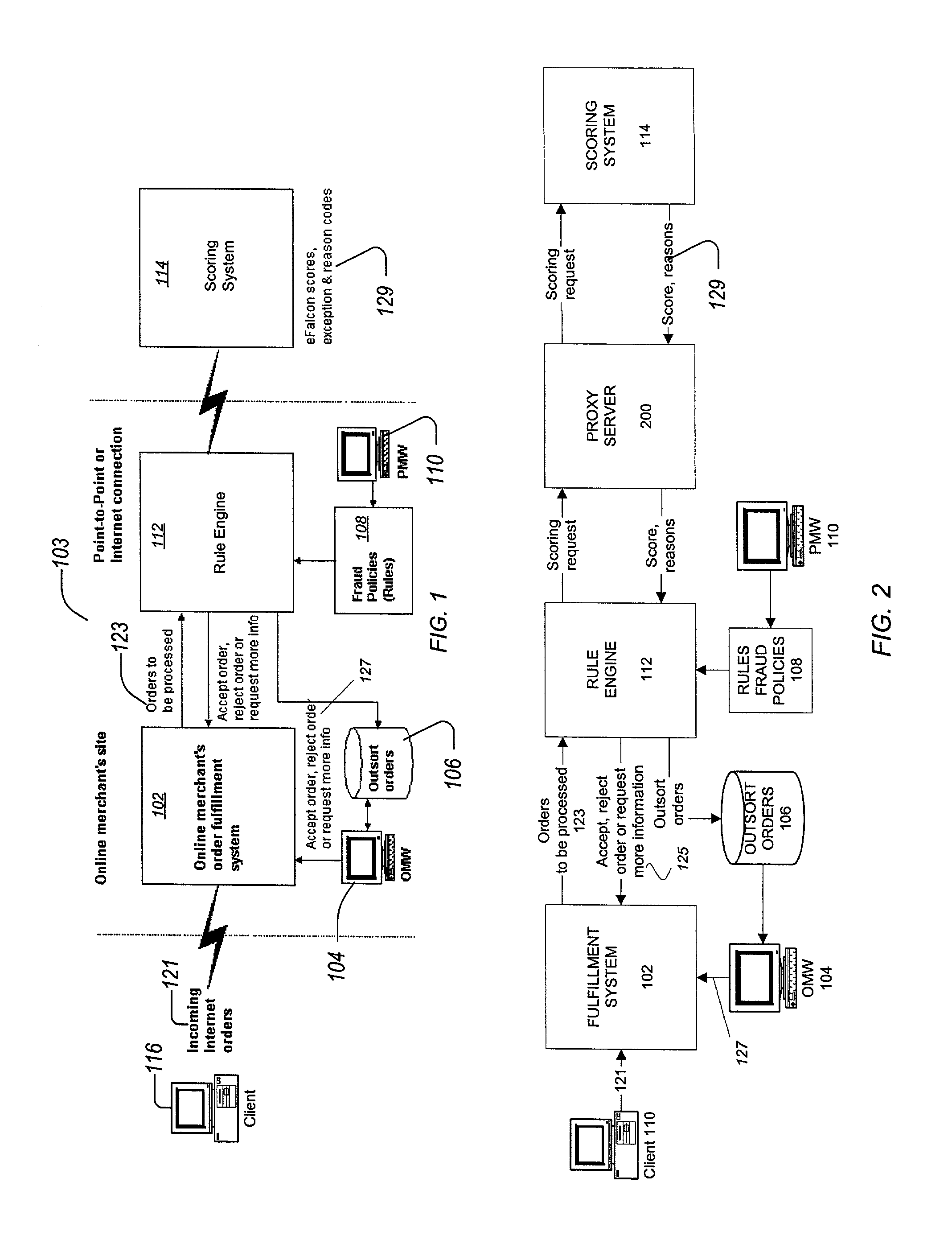

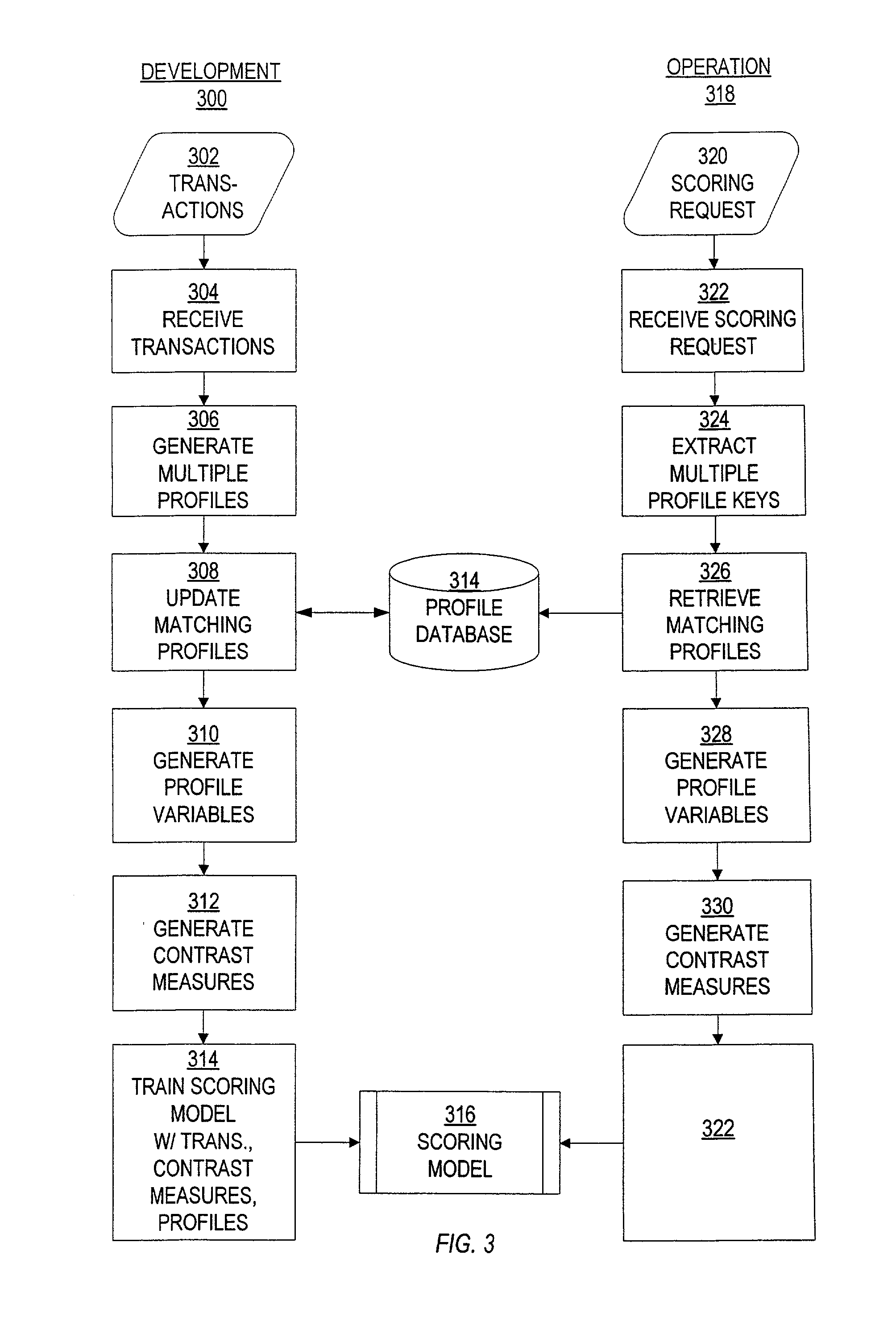

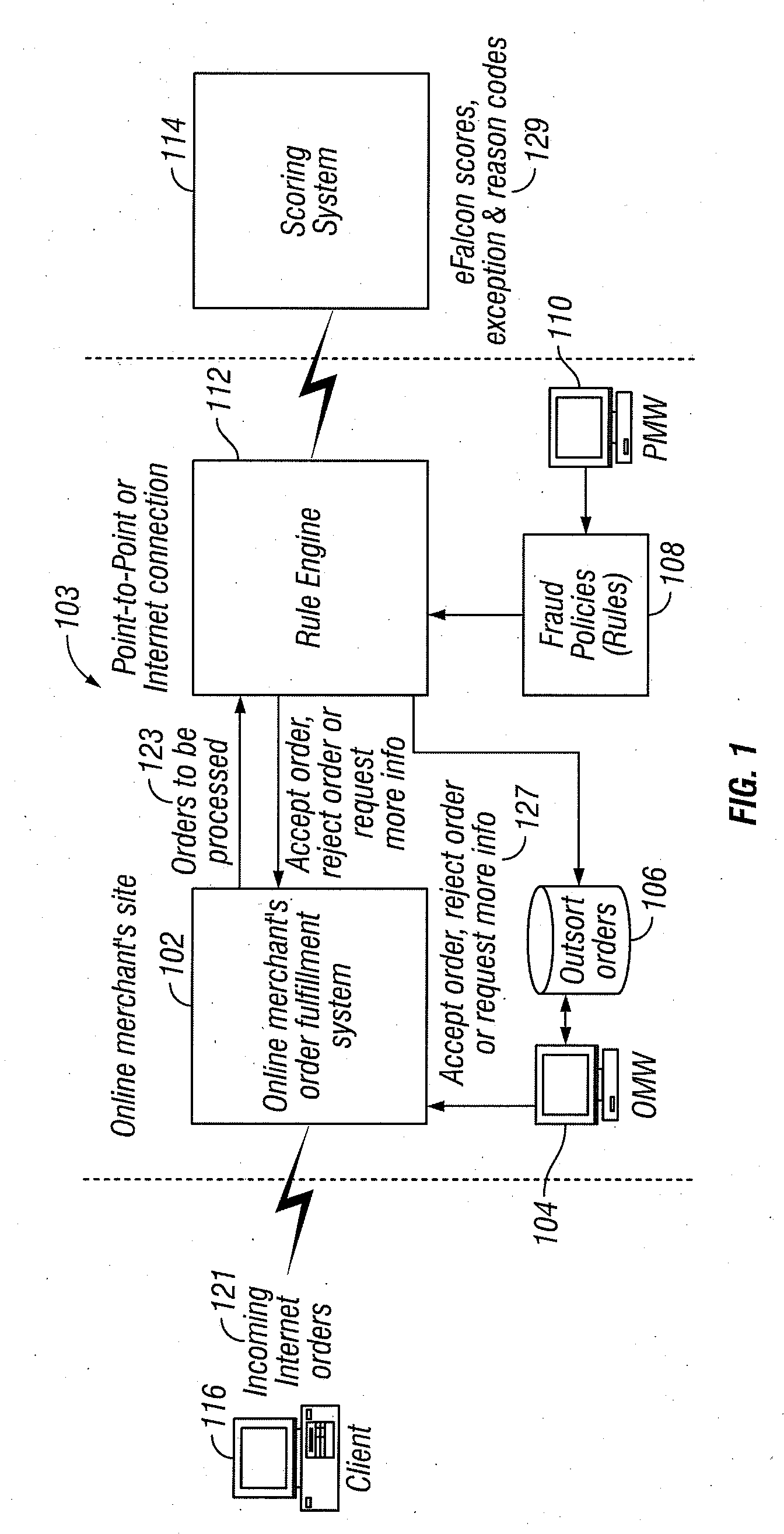

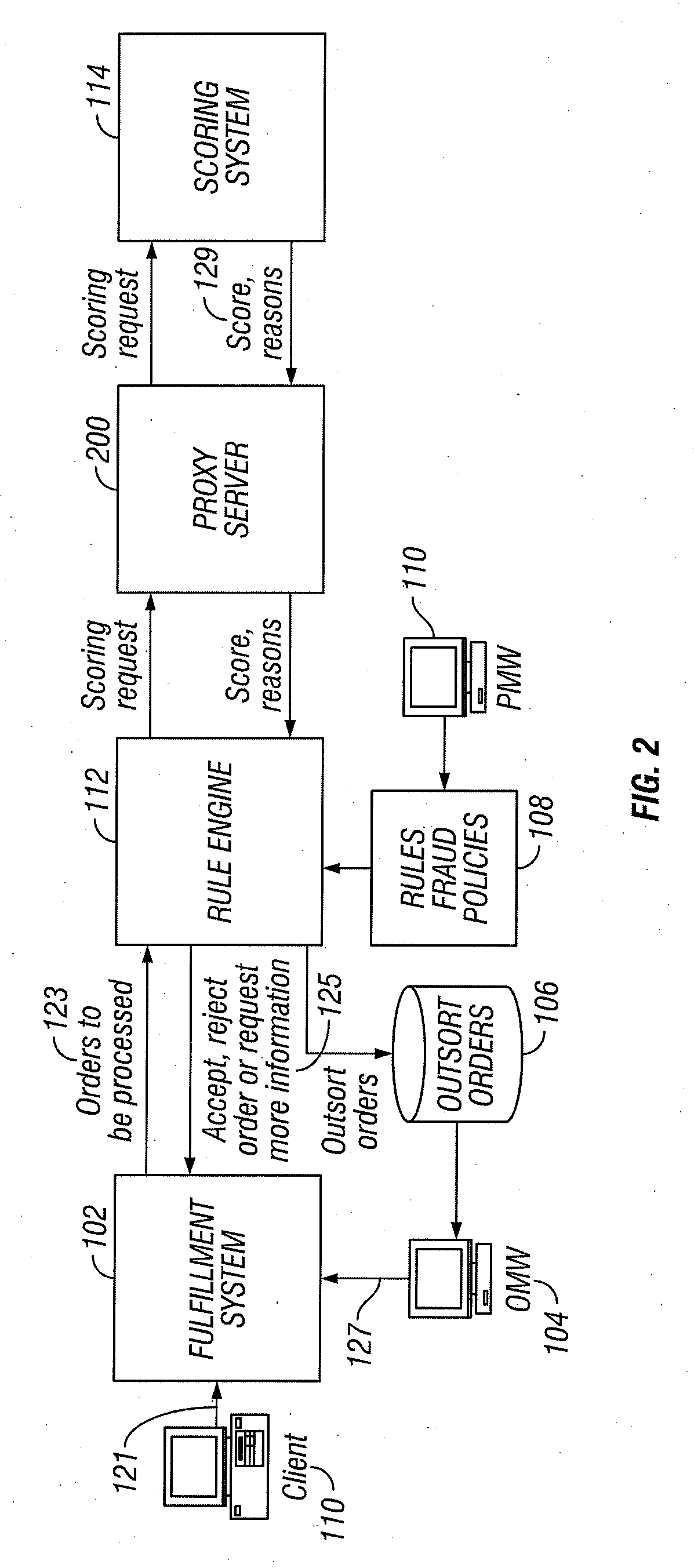

Identification and management of fraudulent credit/debit card purchases at merchant ecommerce sites

ActiveUS7263506B2Reduce exposureFinanceBuying/selling/leasing transactionsE-commerceFinancial transaction

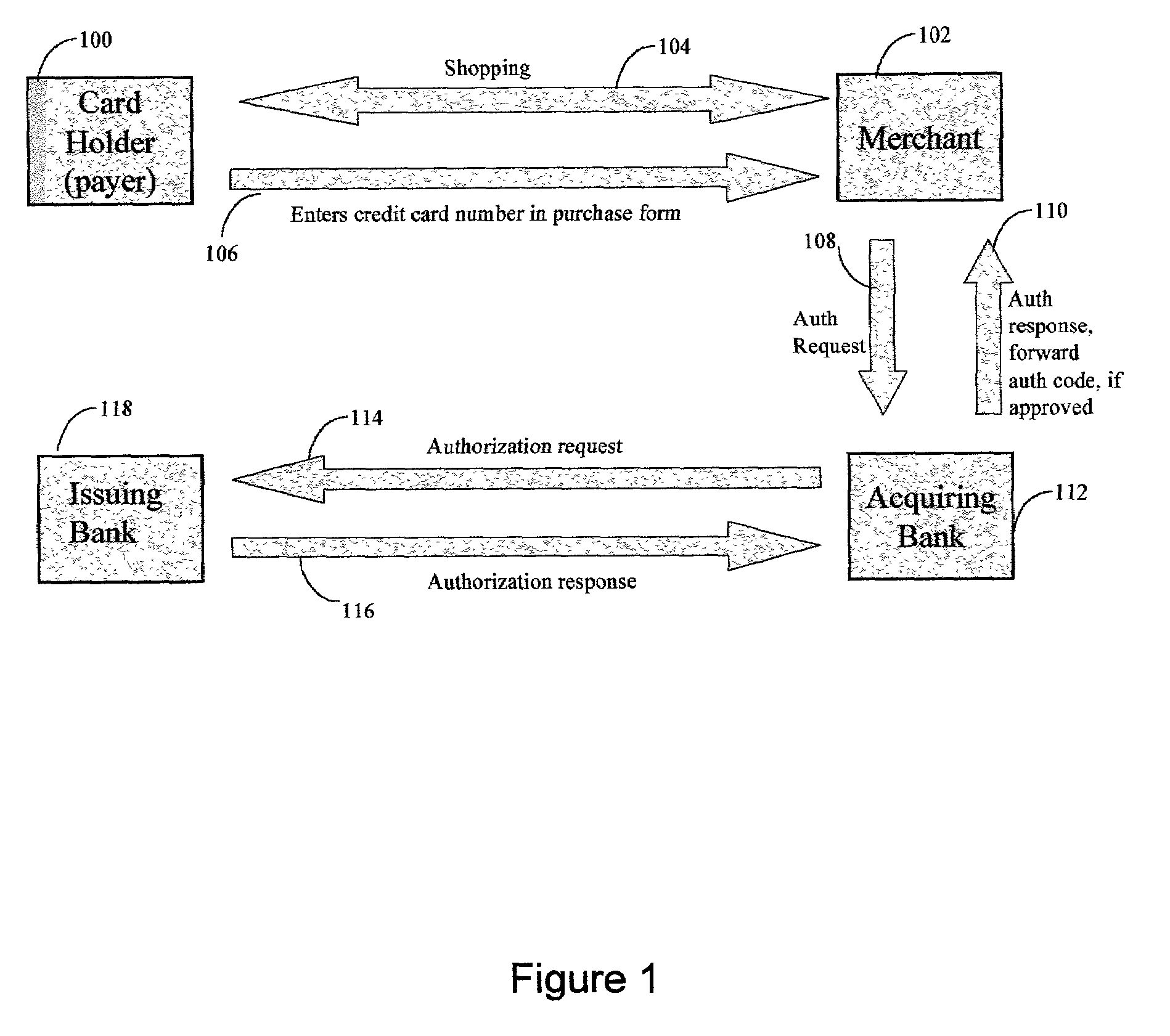

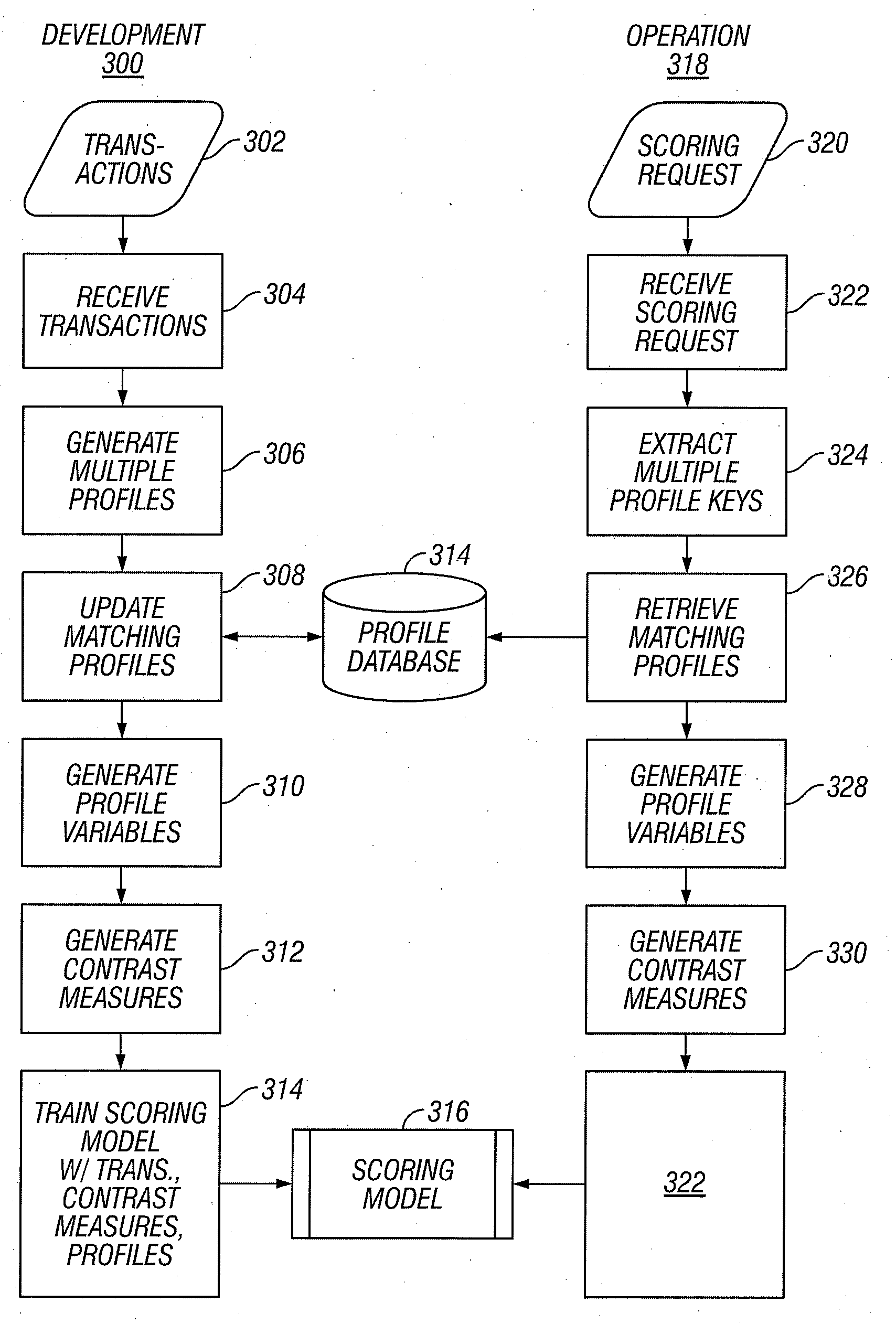

Transaction processing of online transactions at merchant sites determines the likelihood that such transactions are fraudulent, accounting for unreliable fields of a transaction order, which fields do not reliably identify a purchaser. A scoring server using statistical model uses multiple profiles associated with key fields, along with weights to indicate the degree to which the profiles identify the purchaser of the transaction.

Owner:FAIR ISAAC & CO INC

Persistent dynamic payment service

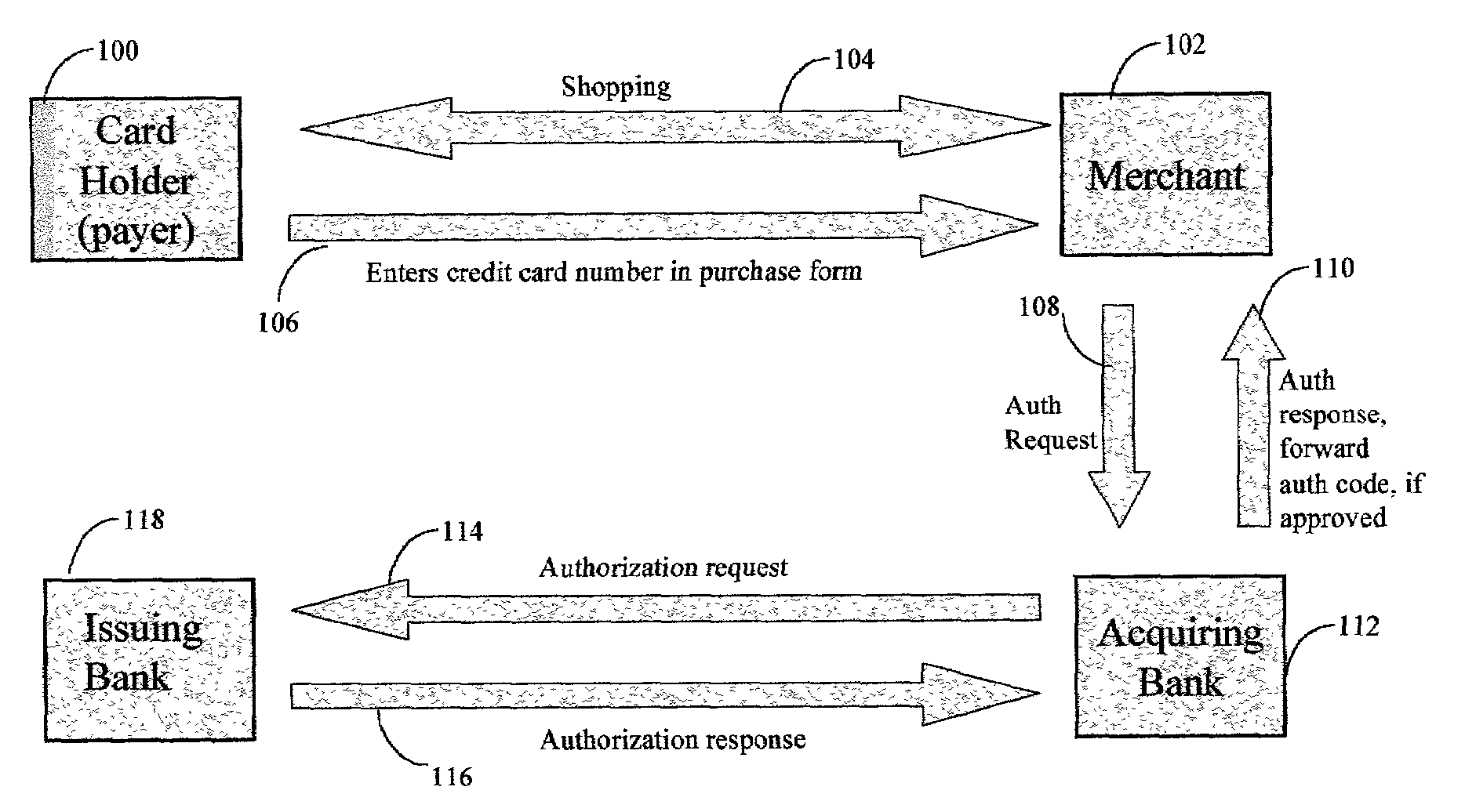

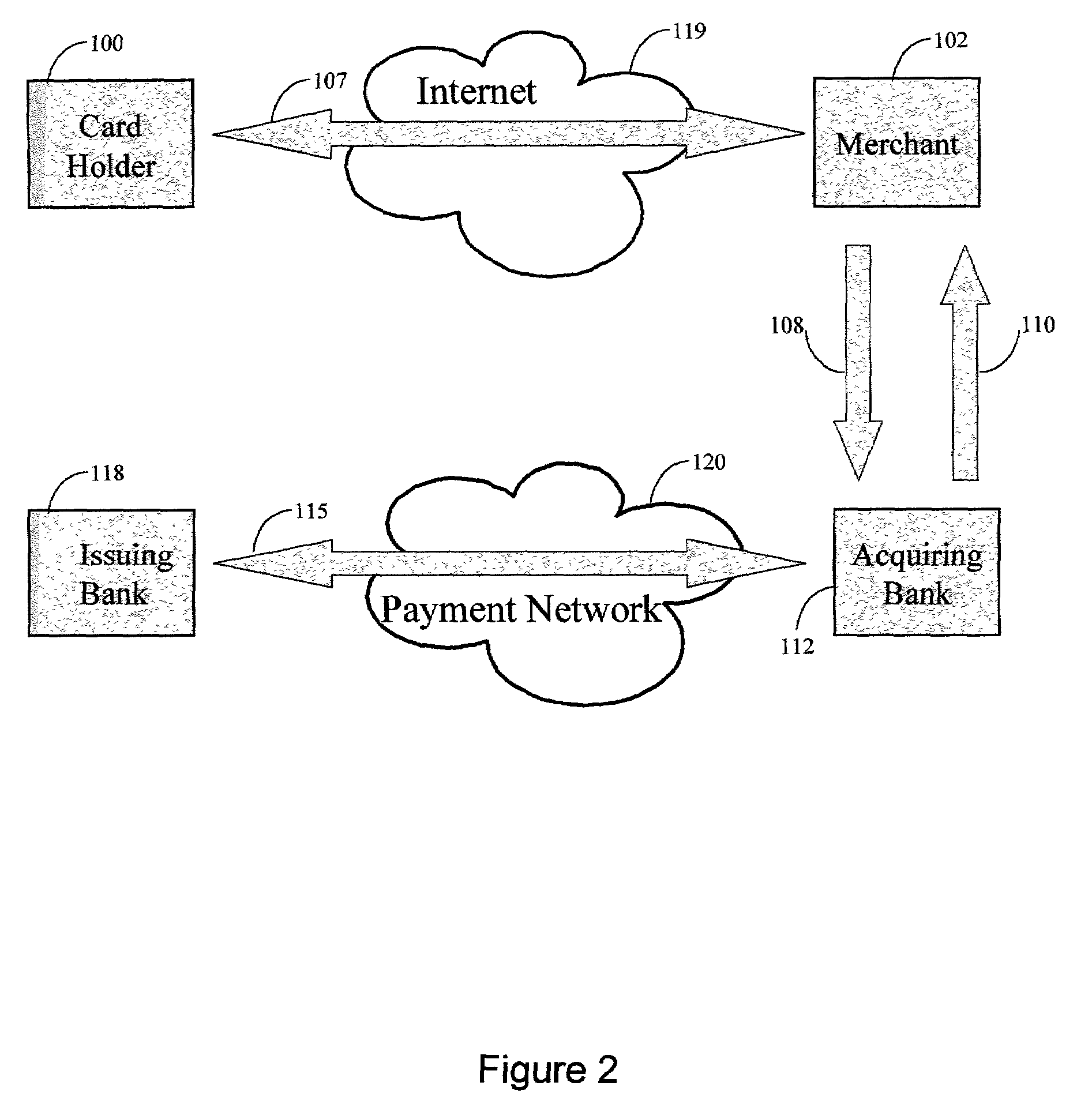

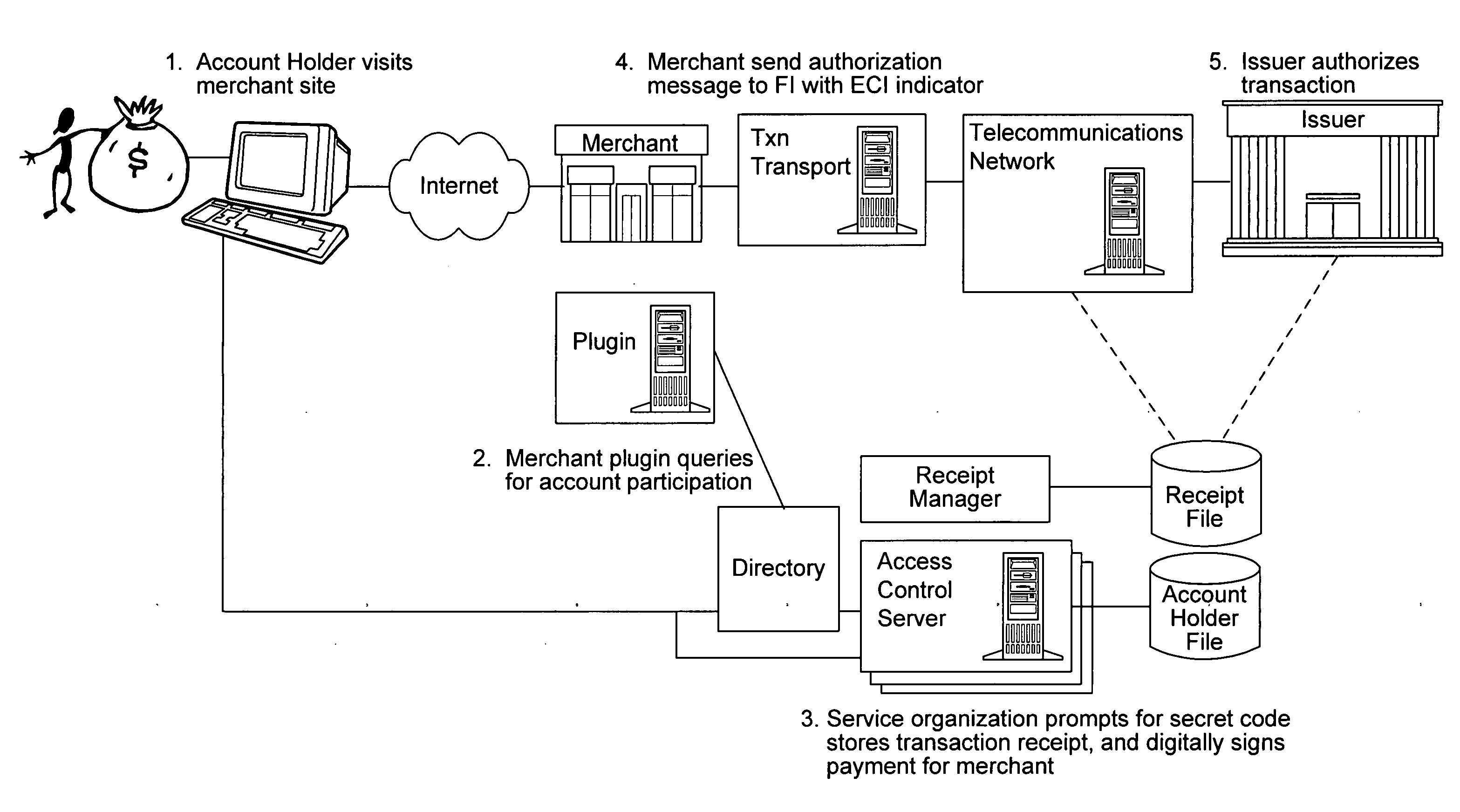

The invention comprises online methods, systems, and software for improving the processing of payments from financial accounts, particularly credit and debit card payments made from consumers to merchants in online transactions. The preferred embodiment of the invention involves inserting a trusted third party online service into the payment authorization process. The trusted third party authenticates the consumer and authorizes the proposed payment in a single integrated process conducted without the involvement of the merchant. The authentication of the consumer is accomplished over a persistent communication channel established with the consumer before a purchase is made. The authentication is done by verifying that the persistent channel is open when authorization is requested. Use of the third party services allows the consumer to avoid revealing his identity and credit card number to the merchant over a public network such as the Internet, while maintaining control of the transaction during the authorization process.

Owner:FISHER DOUGLAS C

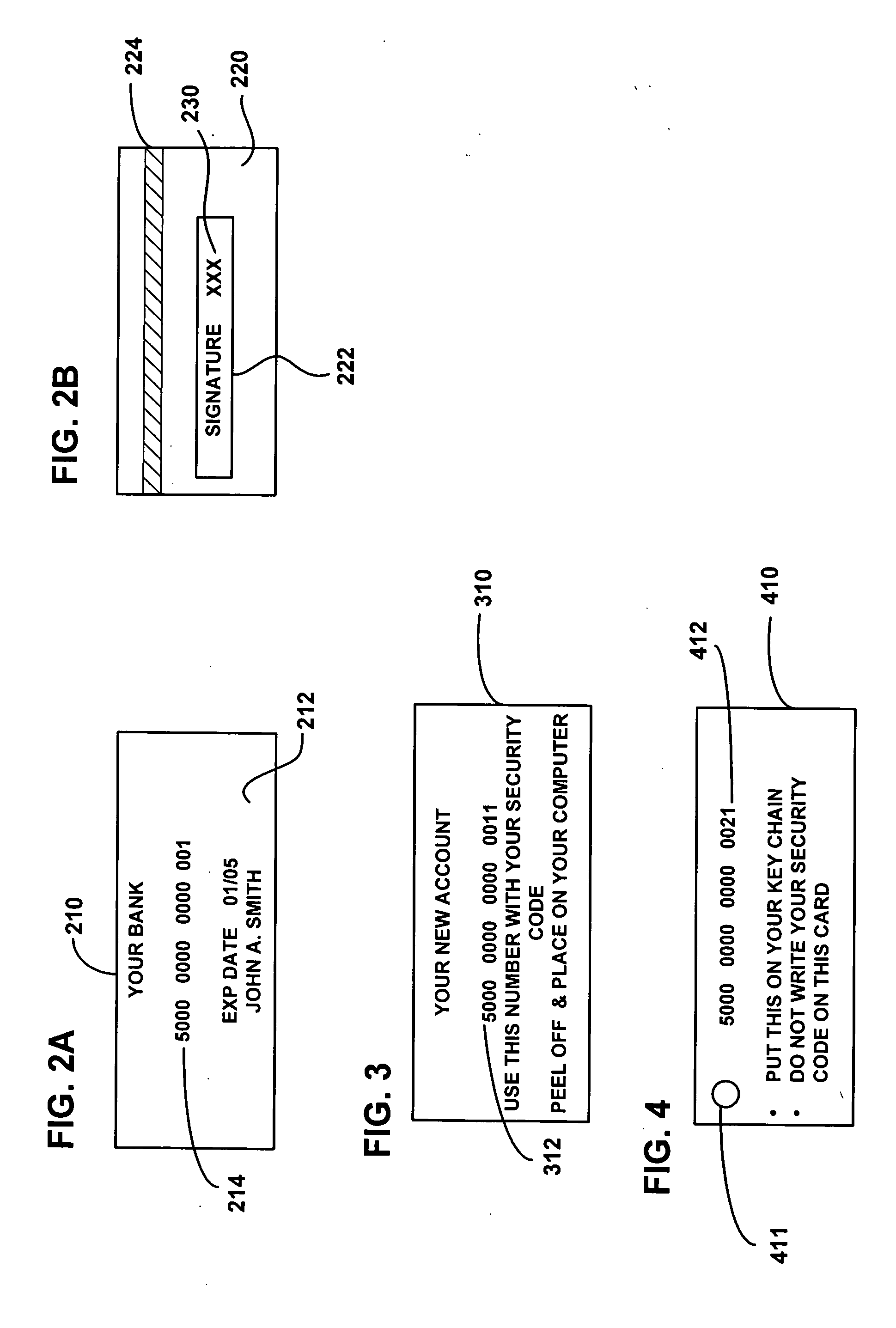

System and method for secure account transactions

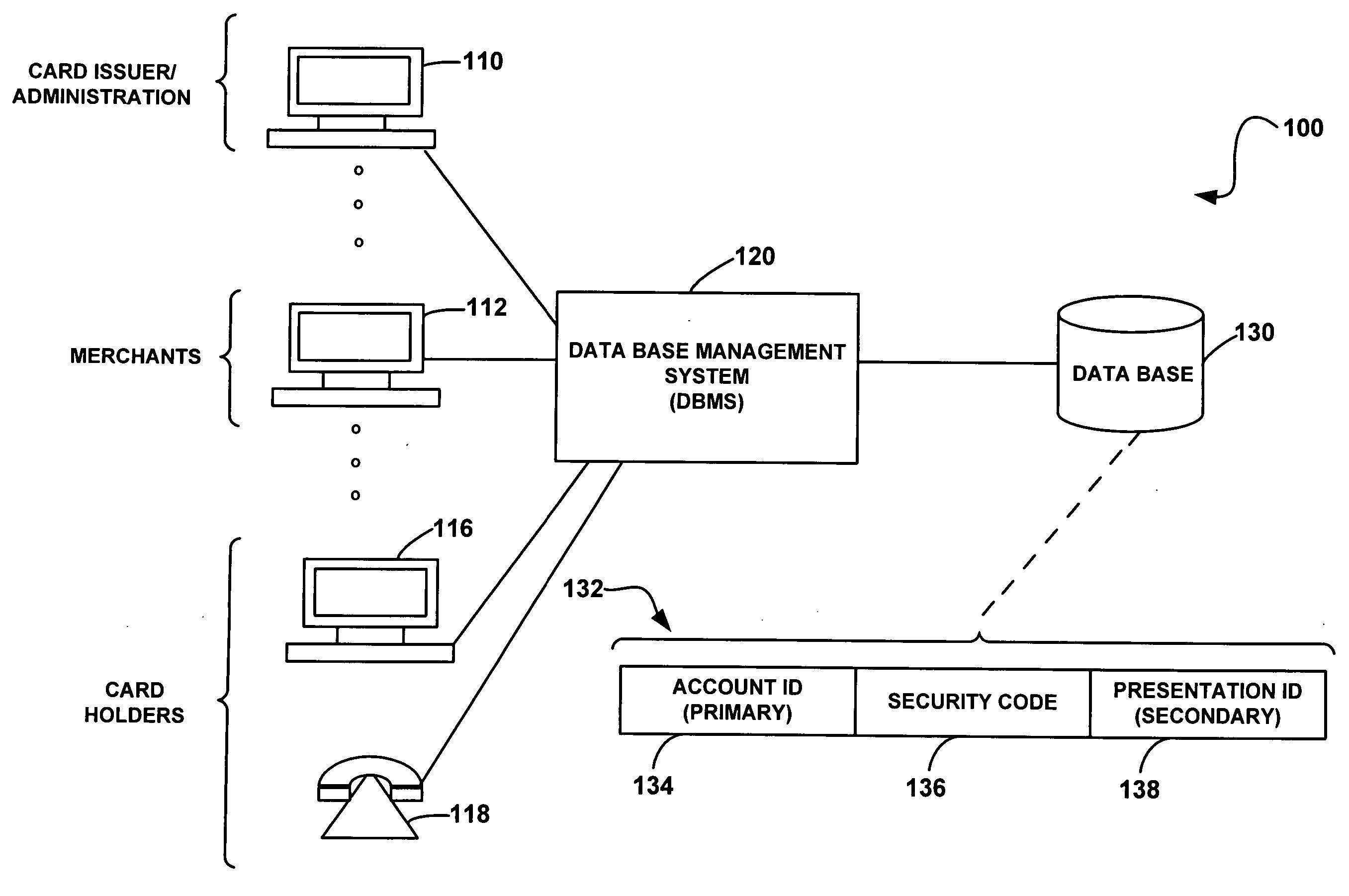

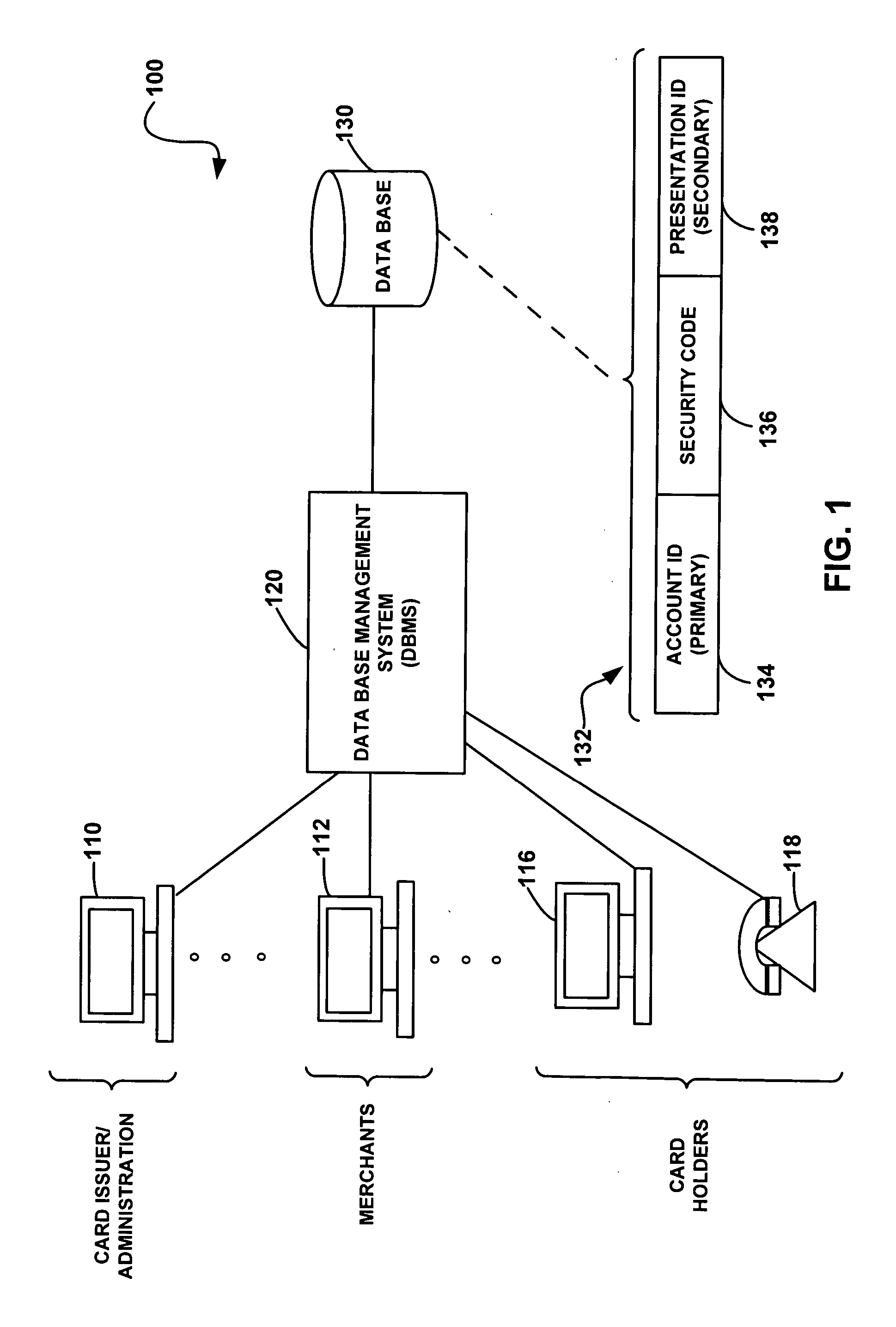

A credit card management system and method wherein a customer with an account is provided a primary credit card with a credit card number and a security code thereon. A secondary presentation instrument associated with the primary credit card is issued for use in conducting on-line transactions. A database stores account information, including the security code associated with the primary account and a secondary account number associated the secondary presentation instrument. When an on-line transaction is conducted, the customer enters both the secondary account number and the security code from the credit card. The secondary presentation instrument is a paper card, a key fob, a printed record or any other virtual credit card.

Owner:FIRST DATA

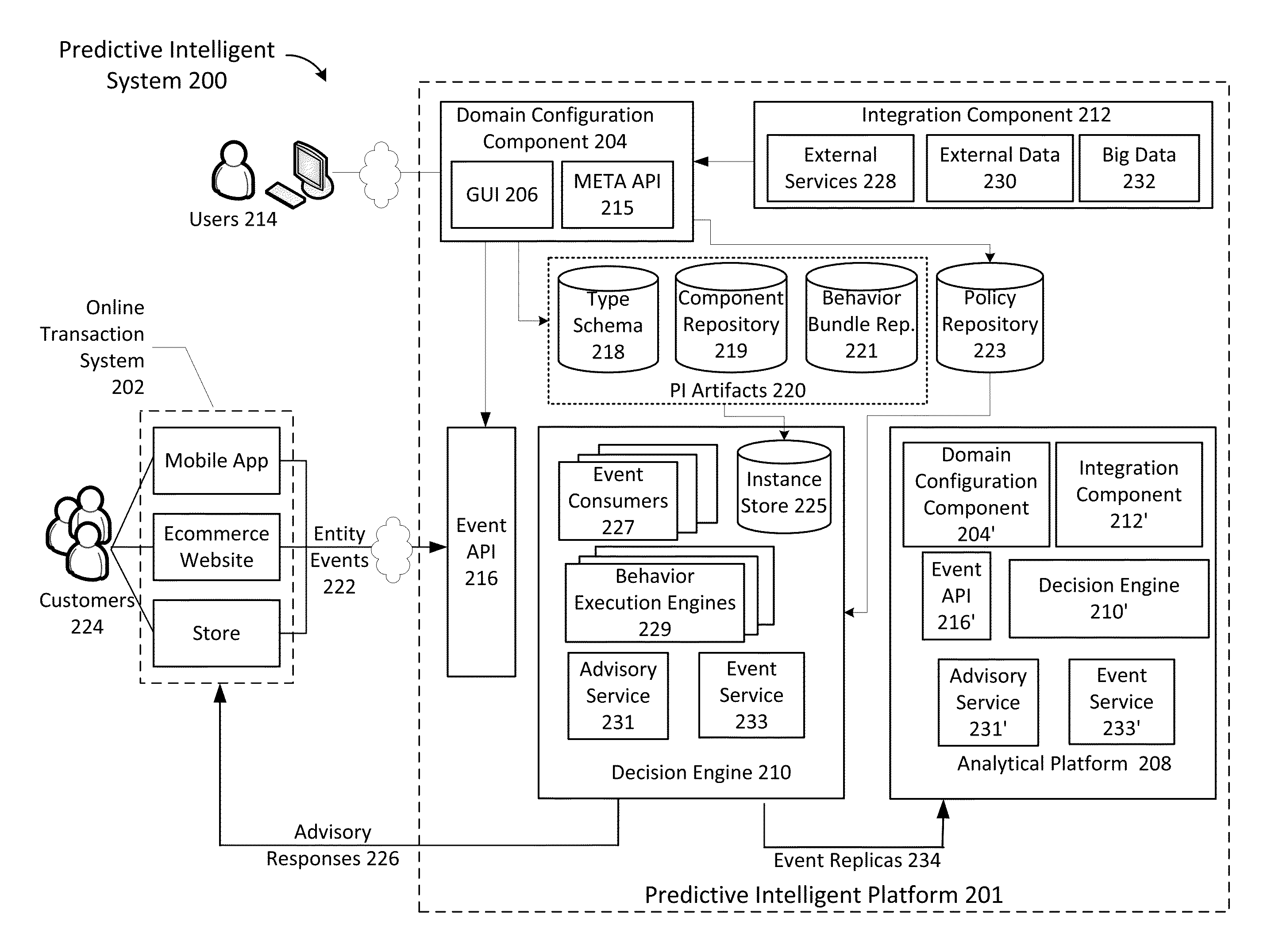

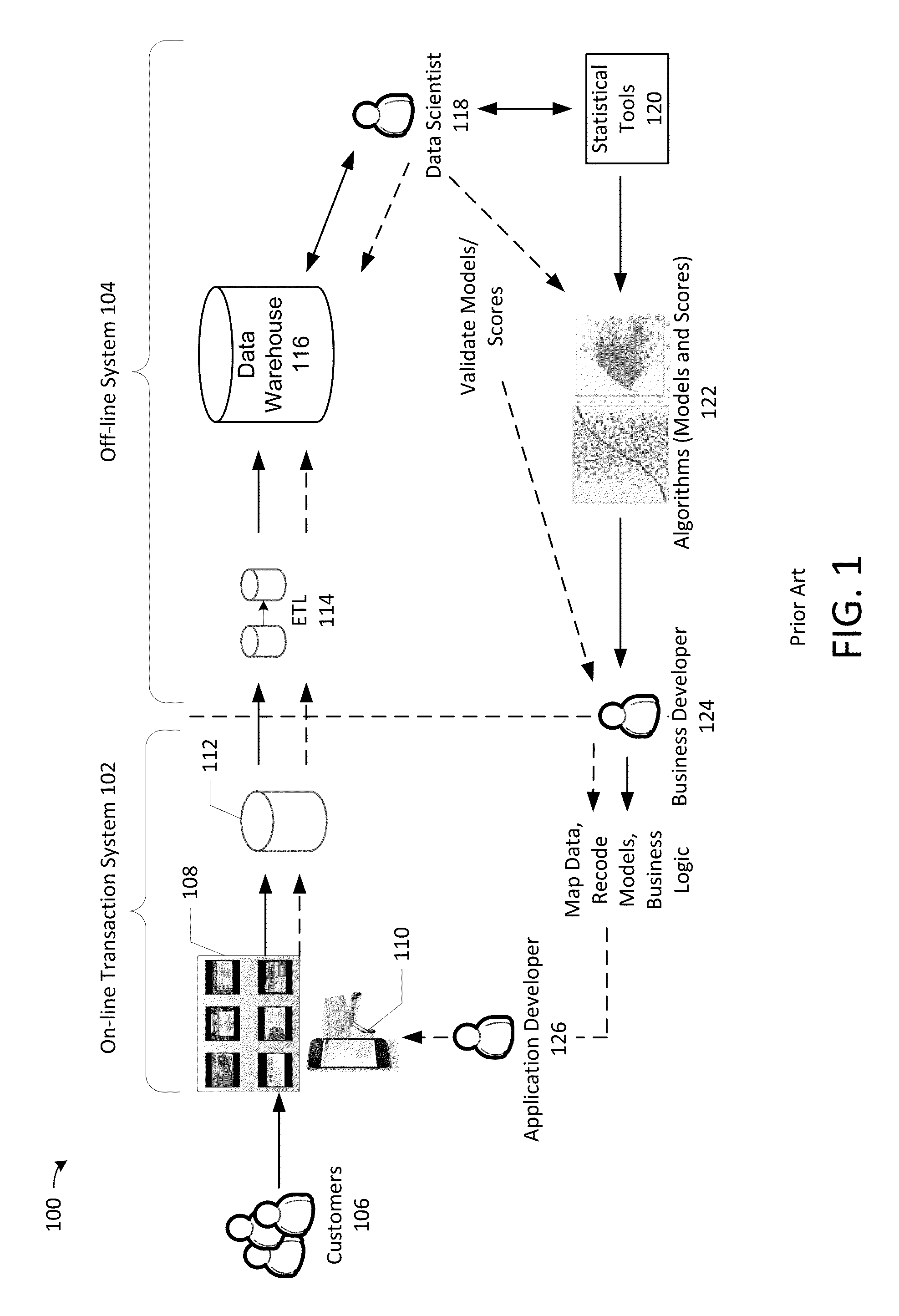

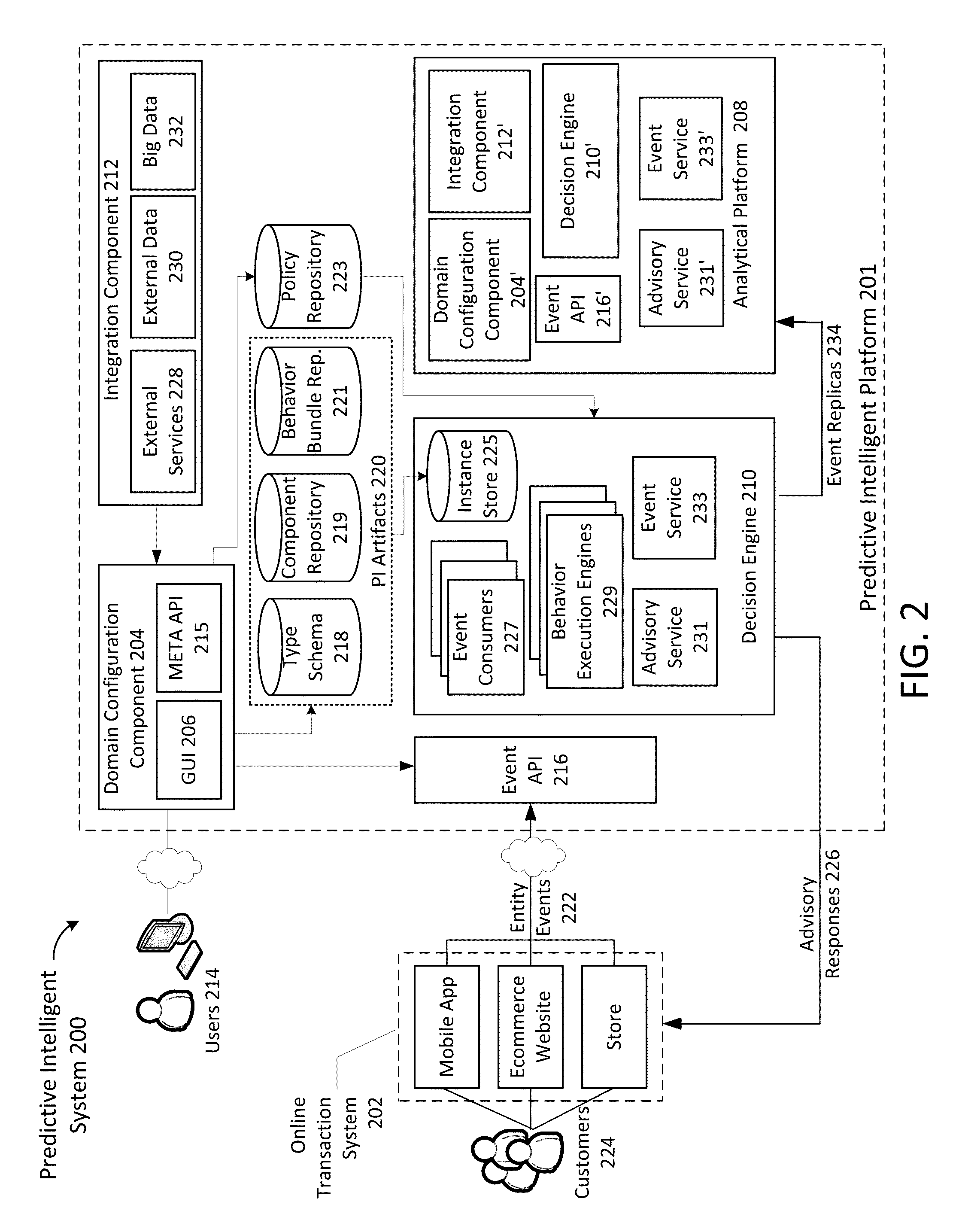

Real-time predictive intelligence platform

ActiveUS20130151453A1Eliminate needProbabilistic networksKnowledge representationEngineeringFinancial transaction

A real-time predictive intelligence platform comprises: receiving from a user through a meta API definitions for predictive intelligence (PI) artifacts that describe a domain of an online transaction system for least one business entity, each of the PI artifacts including types, component modules and behavior bundles; exposing an entity API based on the PI artifacts for receiving entity events from the online transaction system comprising records of interactions and transactions between customers and the online transaction system; responsive to receiving an entity event through the entity API, executing the component modules and behavior bundles to analyze relationships found between past entity events and metrics associated with the past entity events, and computing a probabilistic prediction and / or a score, which is then returned to the online transaction system in real-time; and processing entity event replicas using modified versions of the PI artifacts for experimentation.

Owner:WALMART APOLLO LLC

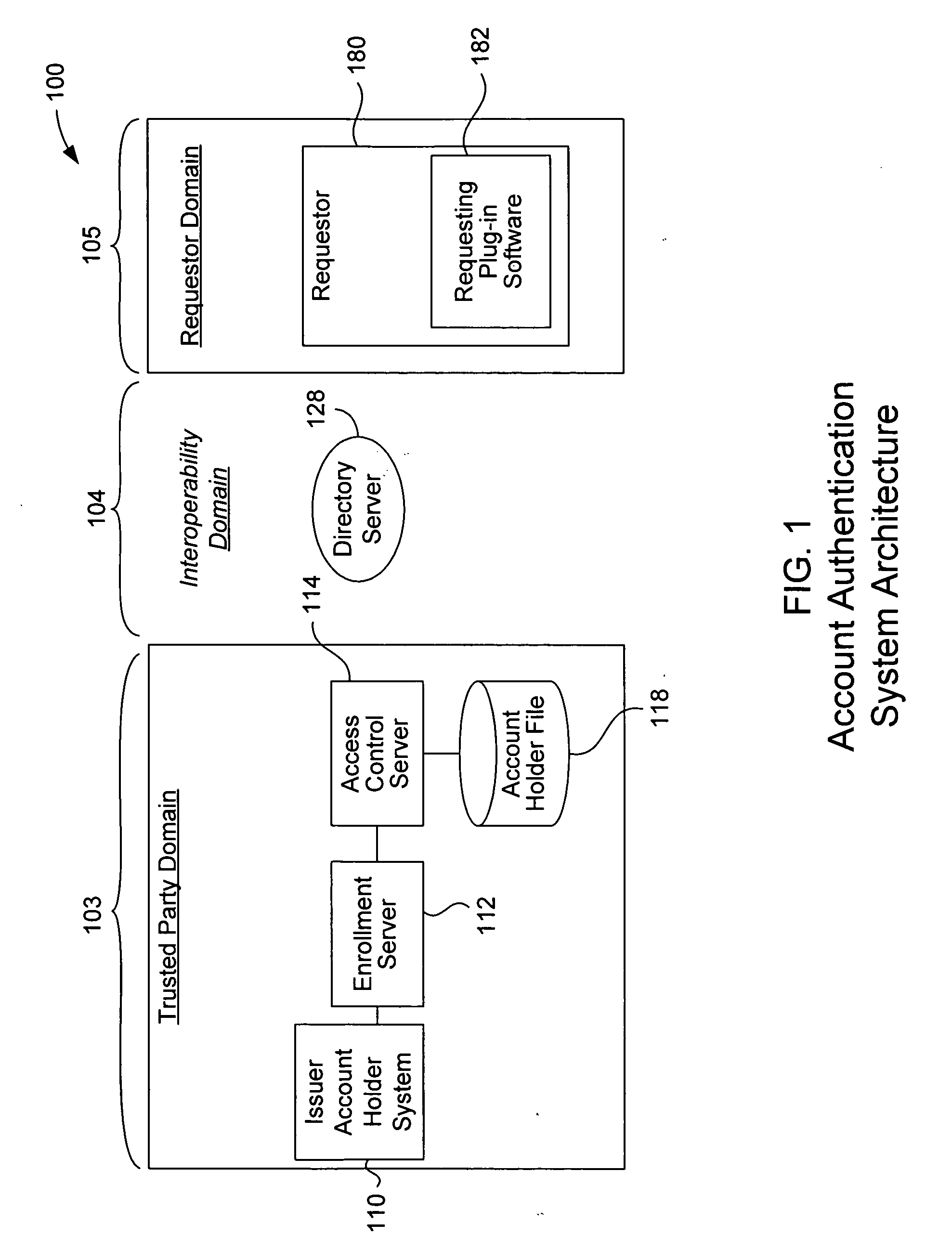

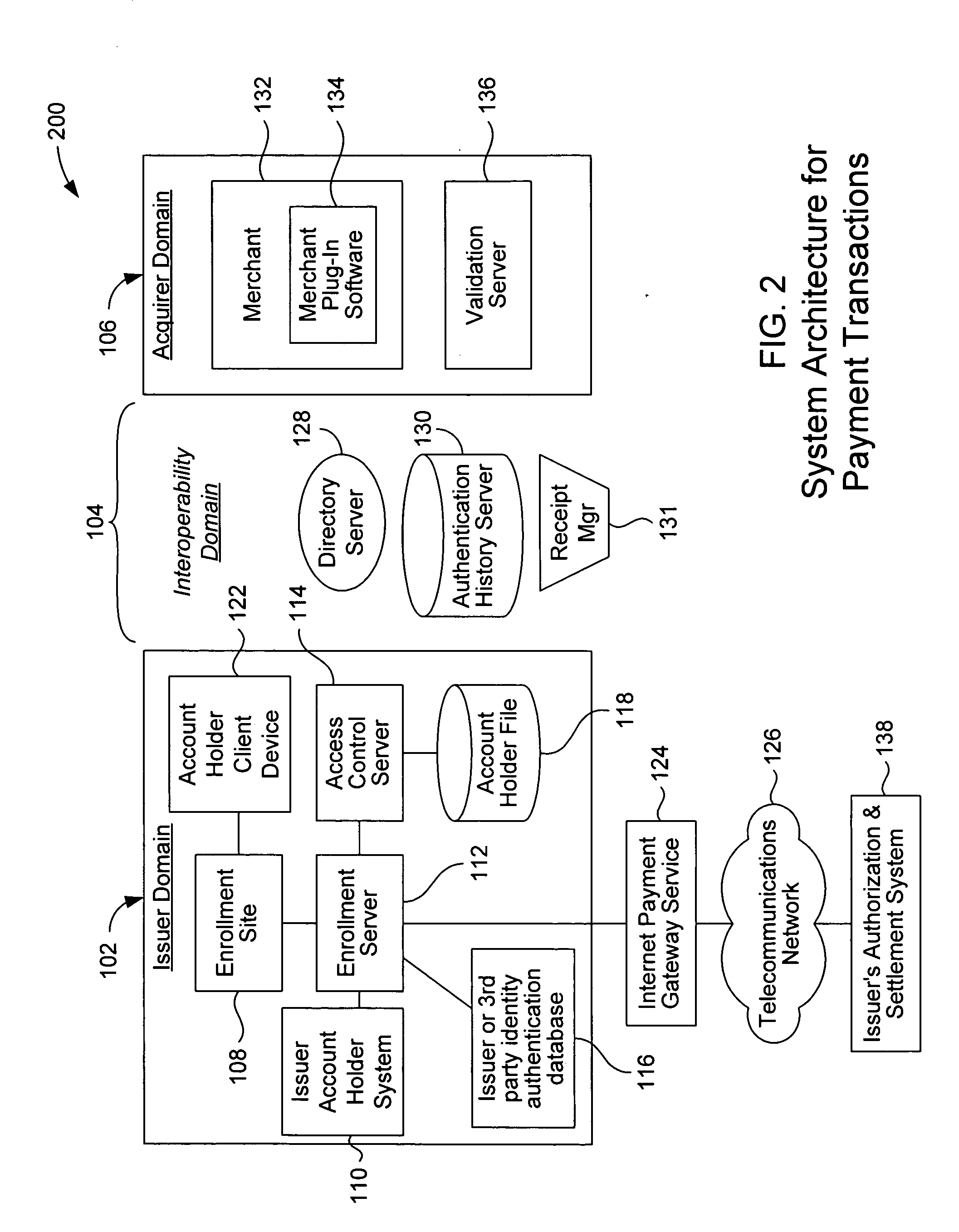

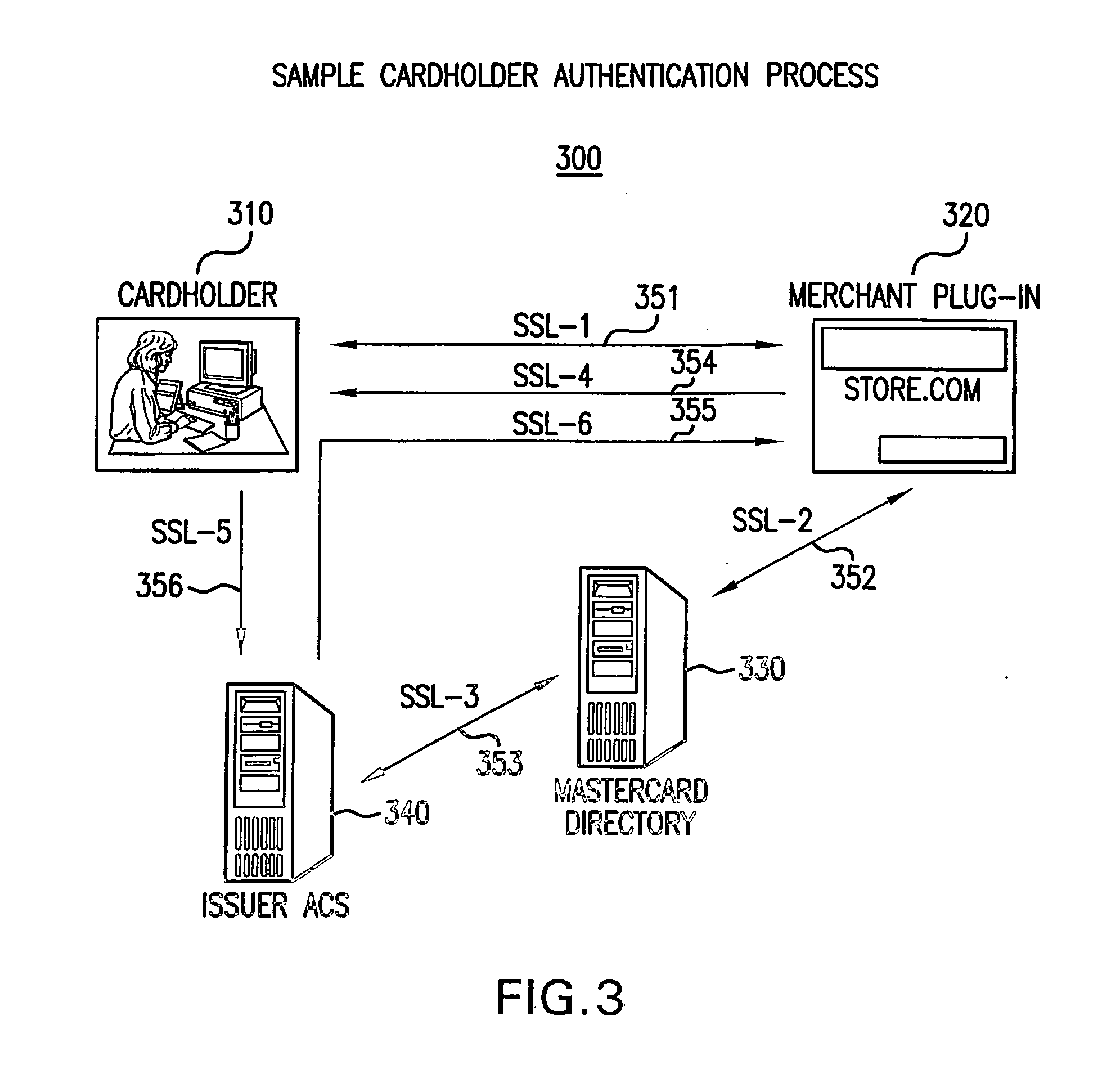

Multiple party benefit from an online authentication service

An account authentication service where a trusted party verifies an account holder's identity for the benefit of a requestor during an online transaction. The account authentication involves requesting a password from the account holder, verifying the password, and notifying the requestor whether the account holder's authenticity has been verified. An alternative embodiment of the account authentication service includes a value-adding component where information about a customer is shared with a value-adding party. The customer information is rich in detail about the customer since it is collected by each of the parties in the account authentication process. The value-adding party can then use this information in various manners. All of the parties involved can benefit from sharing the customer information. The value-adding party can be, for example, a merchant, a shipper, a security organization, or a governmental organization. A transaction identifier identifies a specific transaction between a customer, a merchant, and the customer information.

Owner:VISA INT SERVICE ASSOC

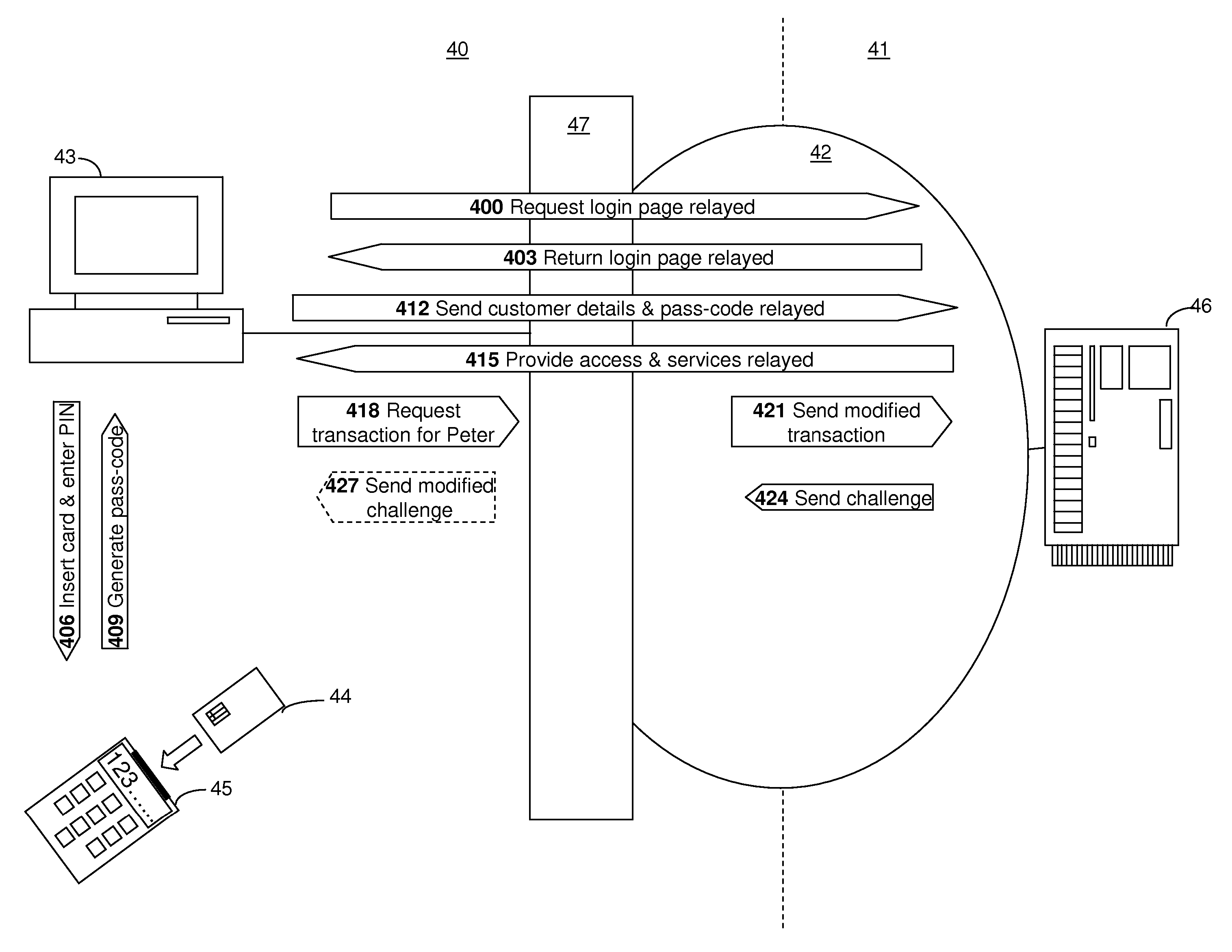

Online transactions systems and methods

InactiveUS20070043681A1Improve securityImprove computing powerAcutation objectsDigital data authenticationMan-in-the-middle attackInternet privacy

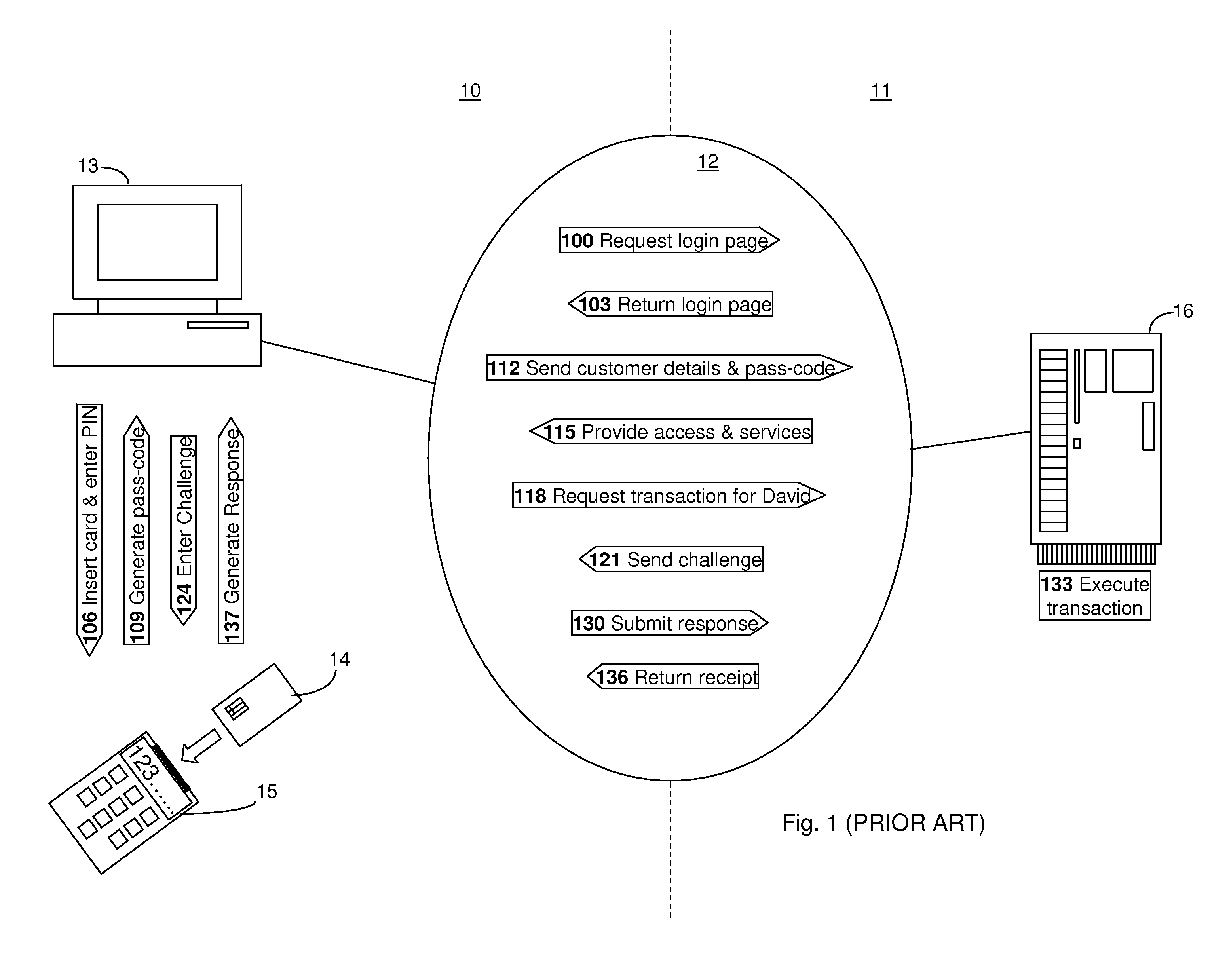

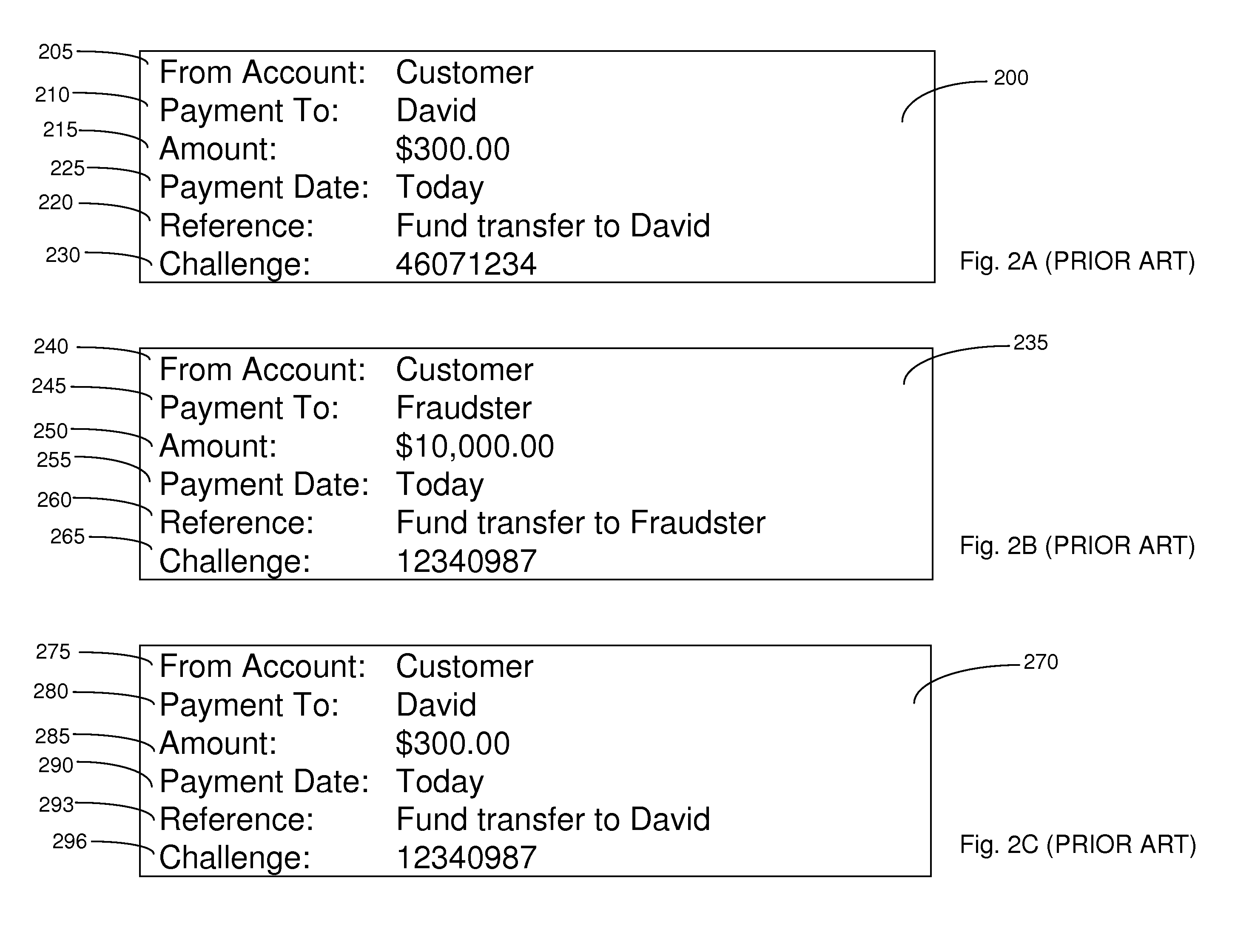

Embodiments of the present invention relate to an online transaction method enacted between a first party and a second party, for example a customer and a bank respectively. The method of the embodiment includes the steps of the first party transmitting a transaction request comprising transaction details and the second party receiving the transaction request and generating, for the first party, an authentication request, comprising transaction details and challenge data. In order to increase the security of the overall transaction, the authentication request is adapted so that it is difficult for an automated process to use or modify information therein to generate a replacement authentication request. Such a method finds application in reducing the potential for a man-in-the-middle attack, wherein an intermediate, subversive process can behave as a legitimate second party in order to steal money from the first party.

Owner:THE ROYAL BANK OF SCOTLAND PLC

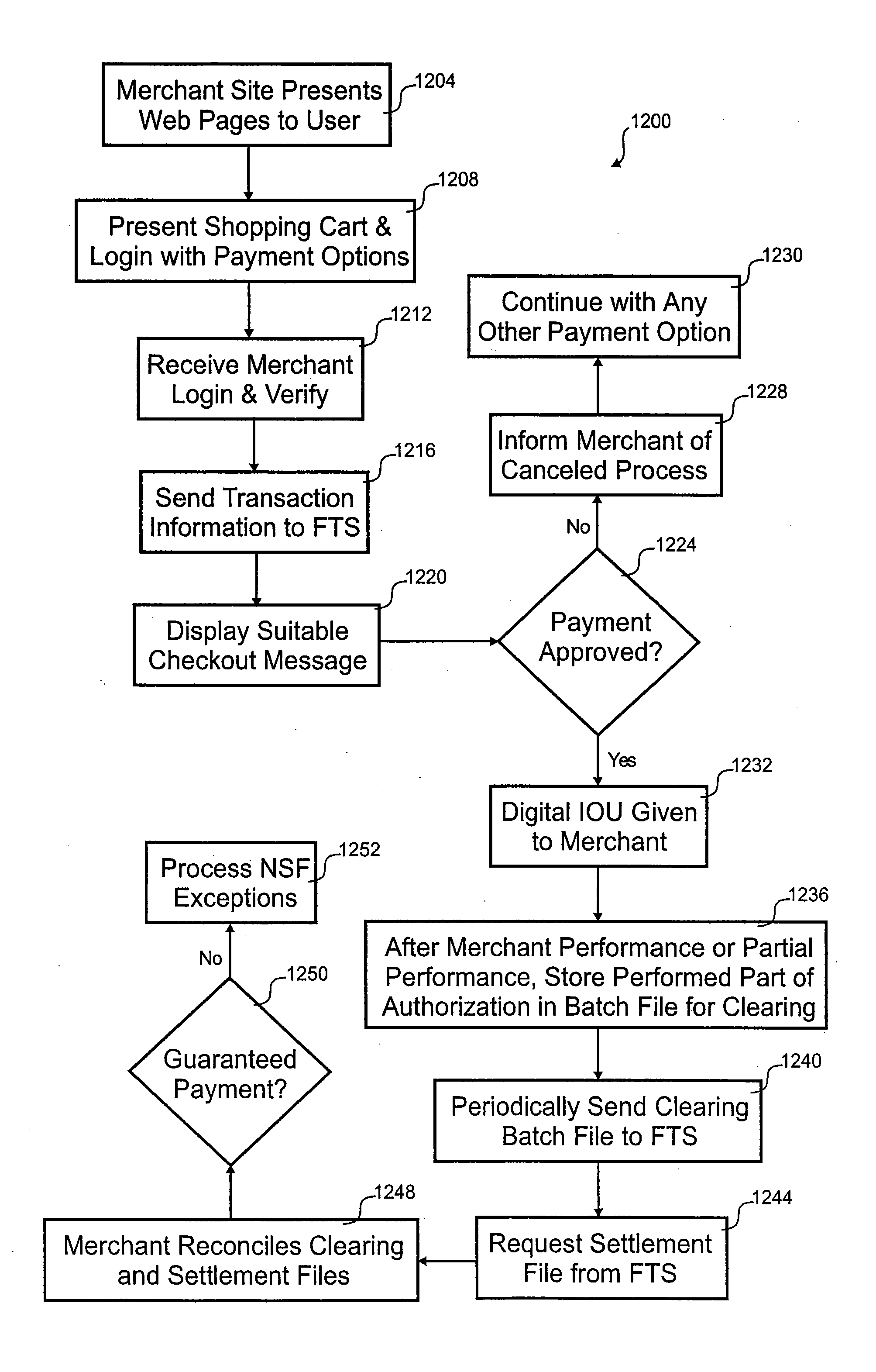

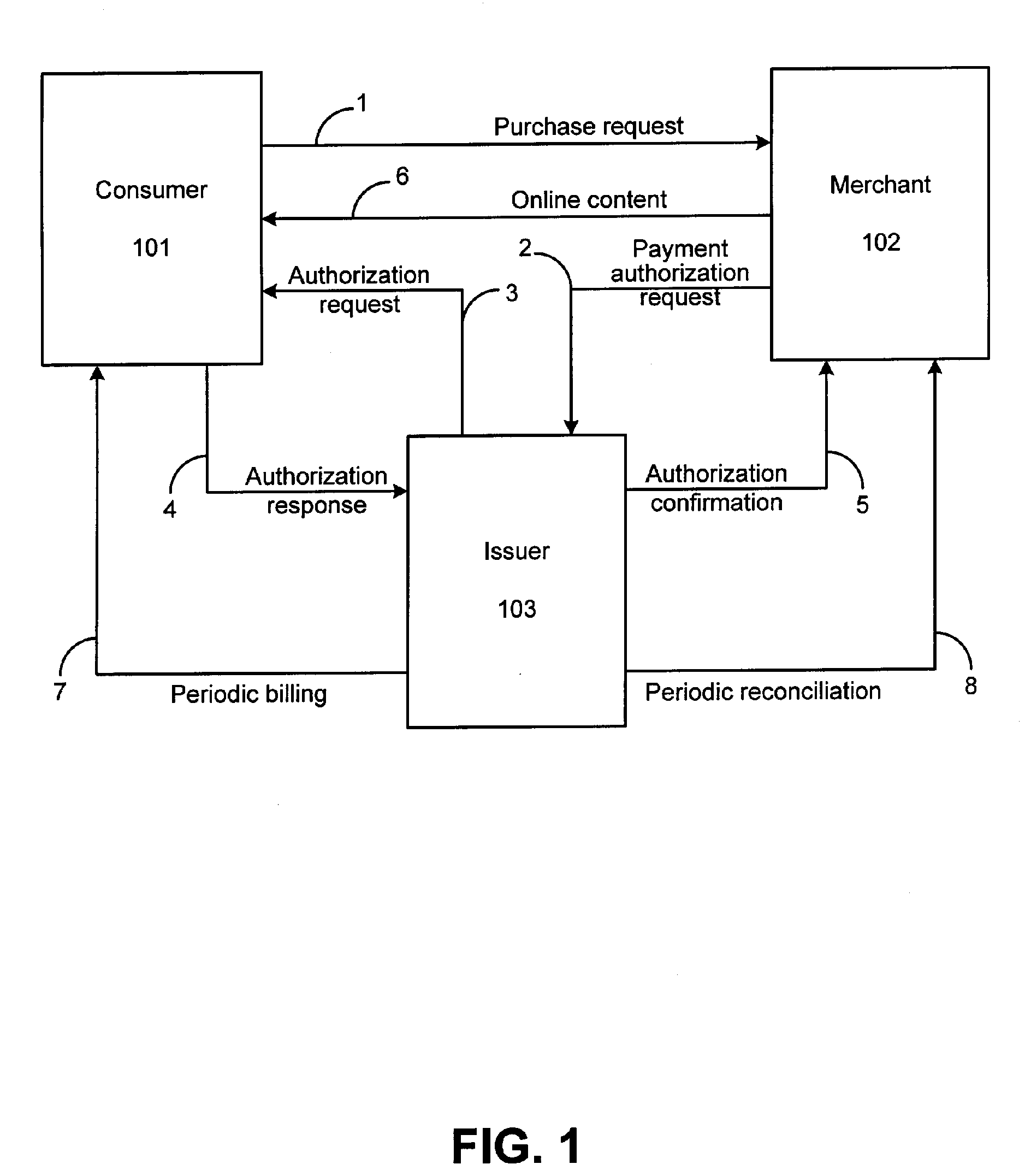

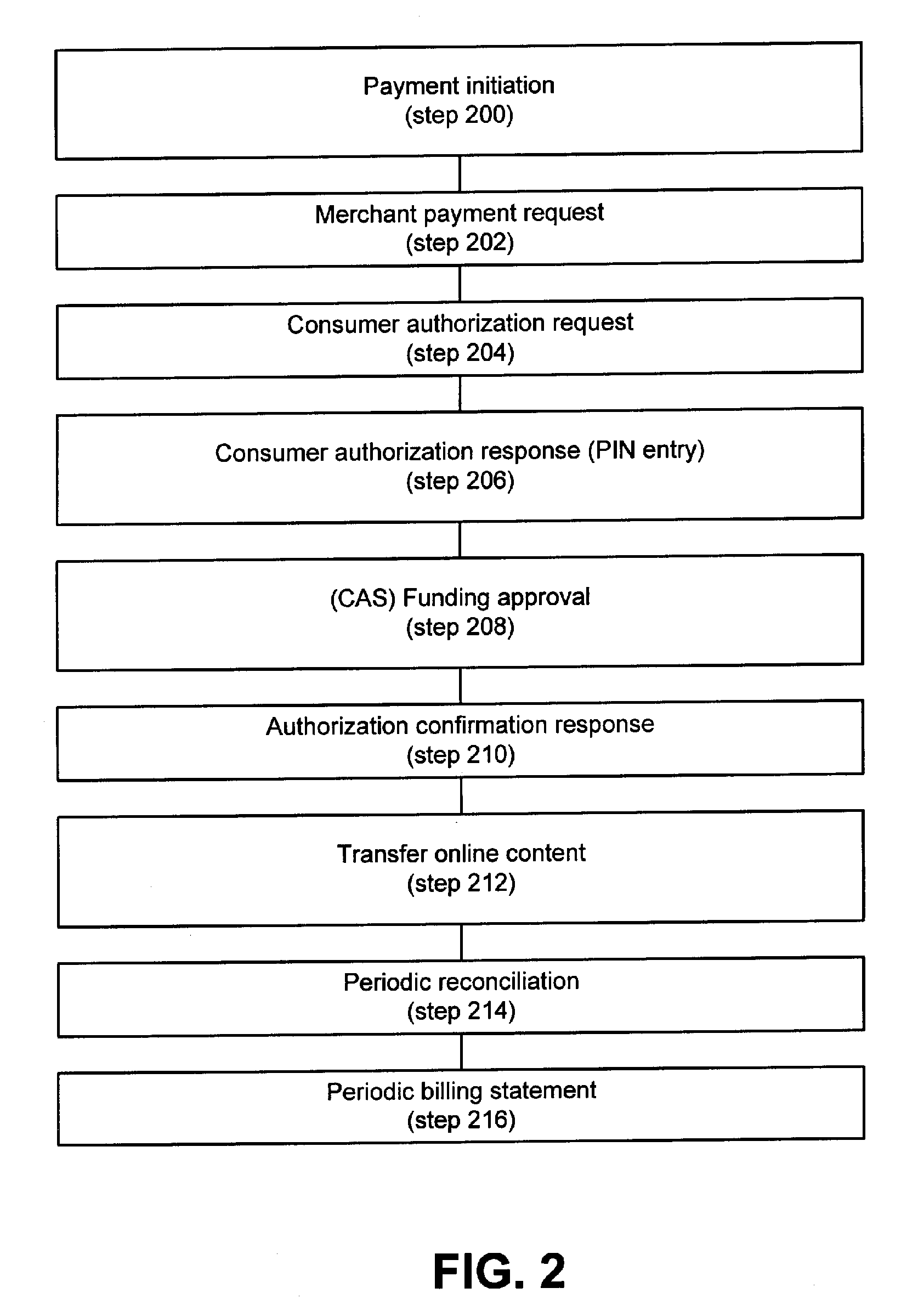

Persistent Dynamic Payment Service

The invention comprises online methods, systems, and software for improving the processing of payments from financial accounts, particularly credit and debit card payments made from consumers to merchants in online transactions. The preferred embodiment of the invention involves inserting a trusted third party online service into the payment authorization process. The trusted third party authenticates the consumer and authorizes the proposed payment in a single integrated process conducted without the involvement of the merchant. The authentication of the consumer is accomplished over a persistent communication channel established with the consumer before a purchase is made. The authentication is done by verifying that the persistent channel is open when authorization is requested. Use of the third party services allows the consumer to avoid revealing his identity and credit card number to the merchant over a public network such as the Internet, while maintaining control of the transaction during the authorization process.

Owner:FISHER DOUGLAS C +1

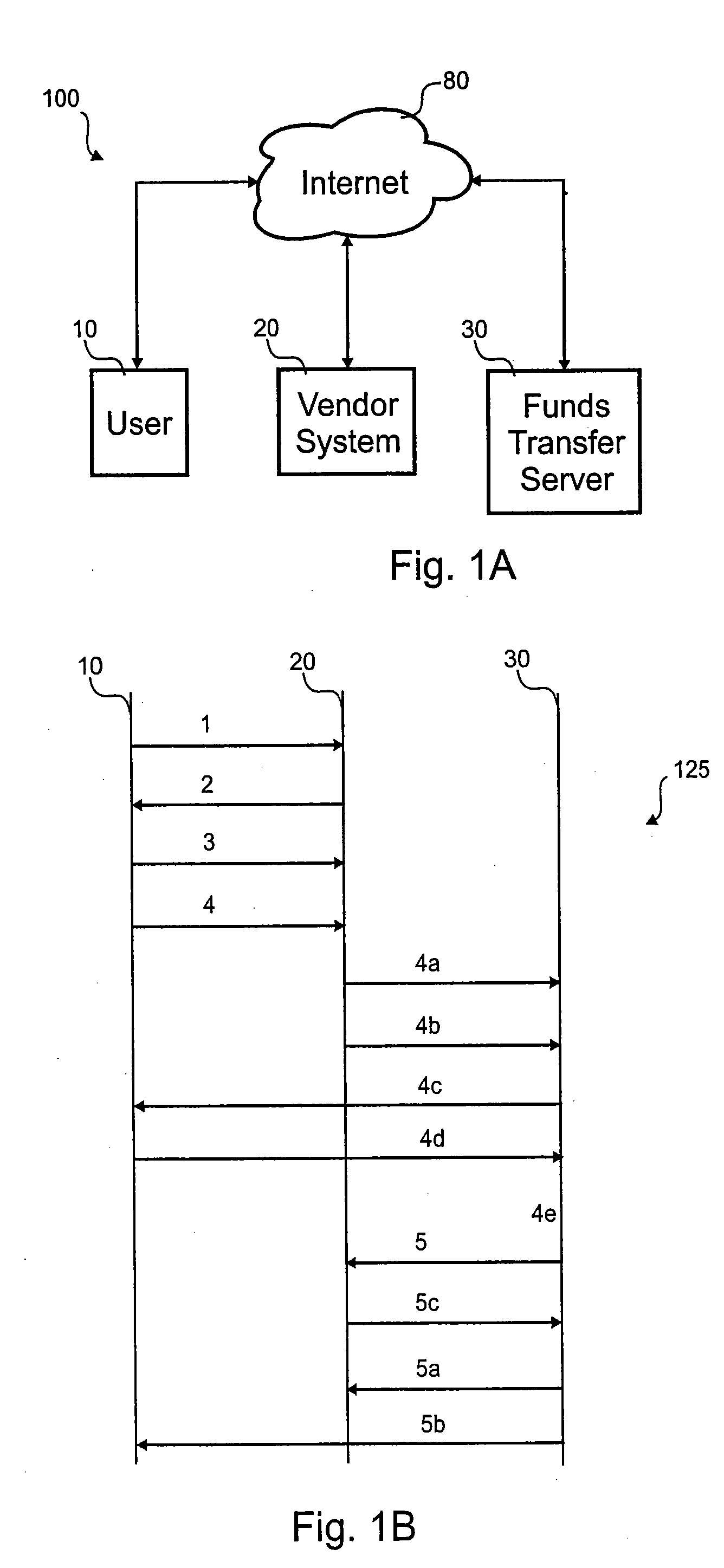

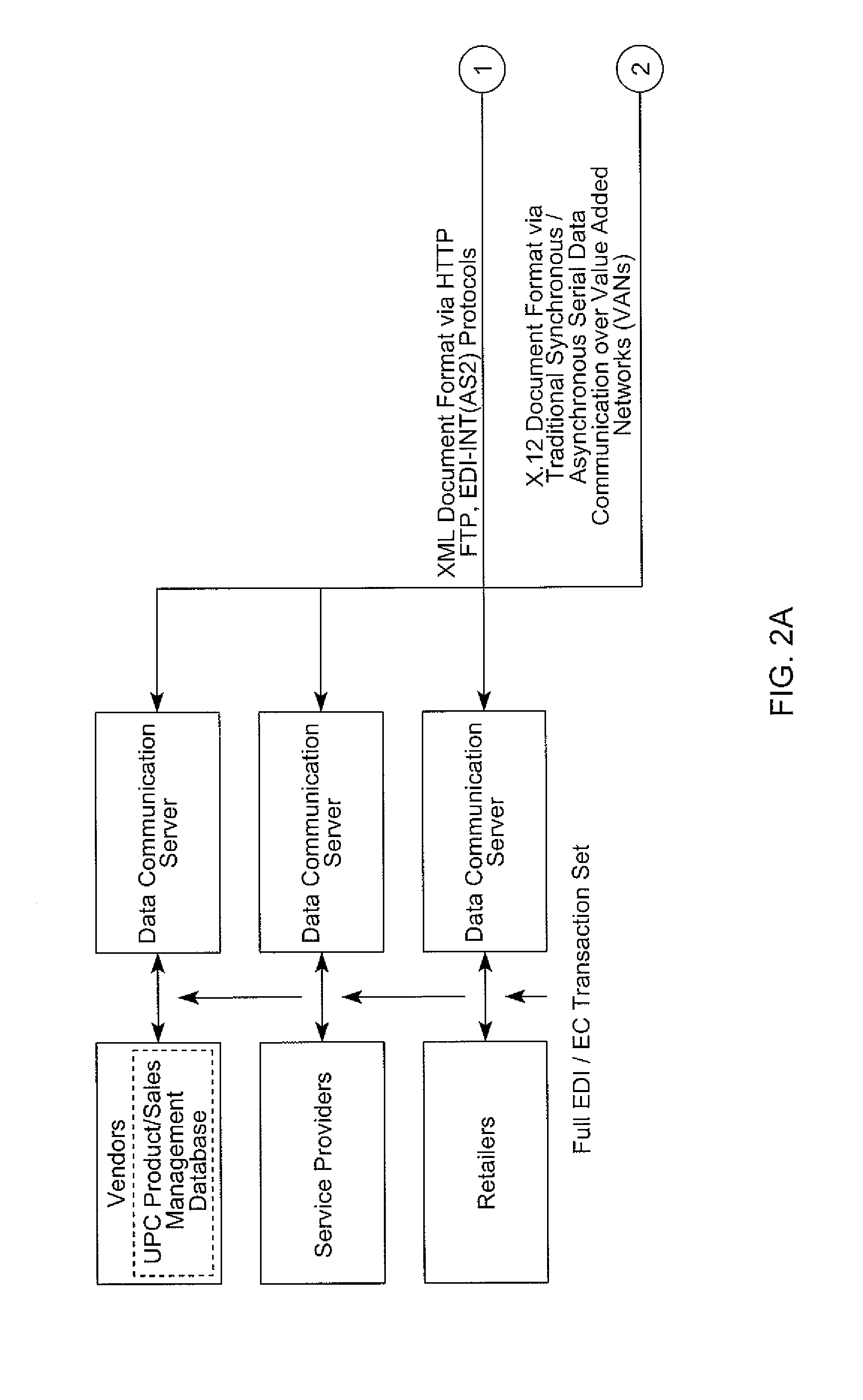

Transportation system for on-line transactions

InactiveUS20020052853A1Improve business satisfactionImprove operationFinancePayment circuitsMerchant servicesUser device

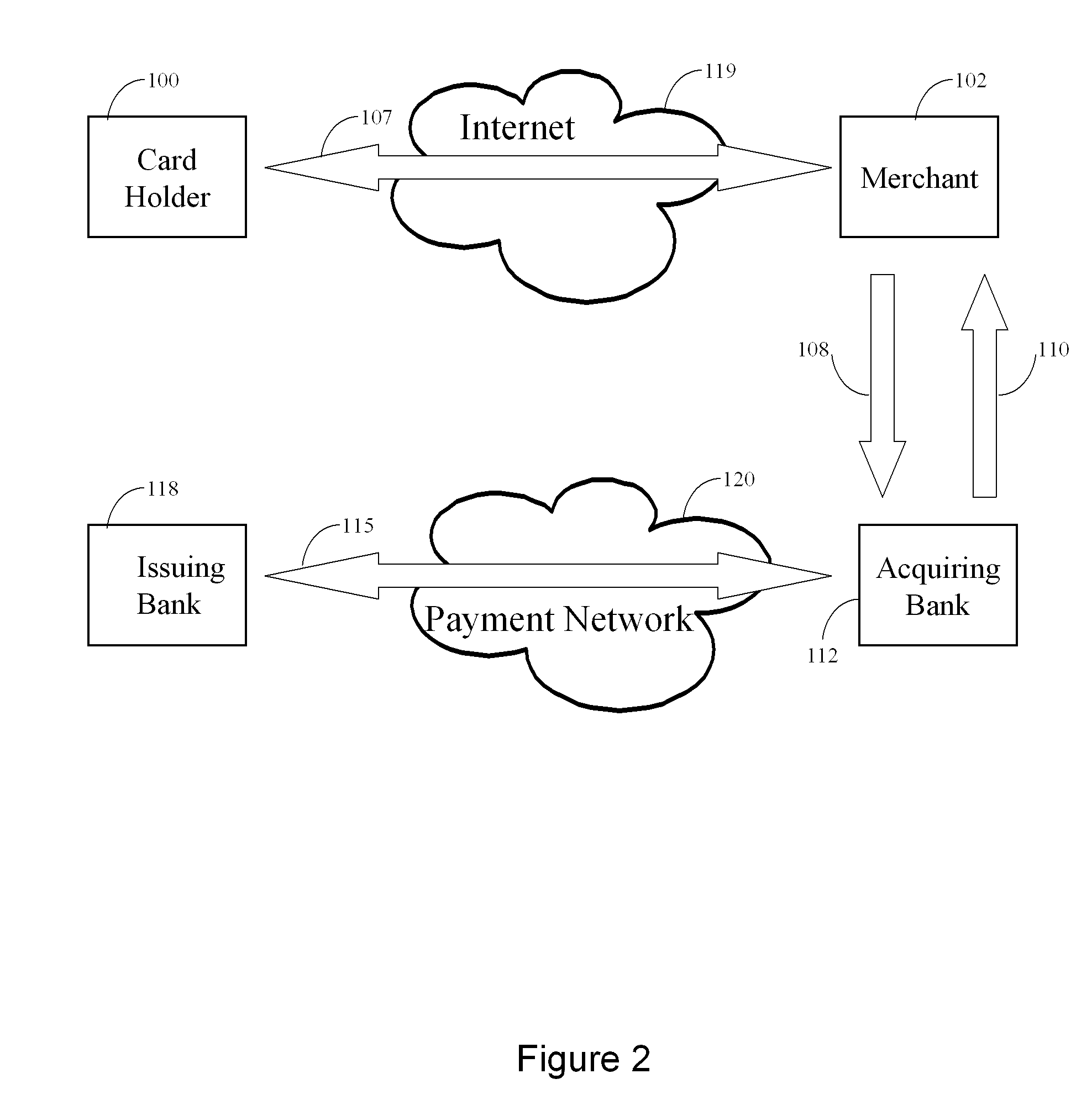

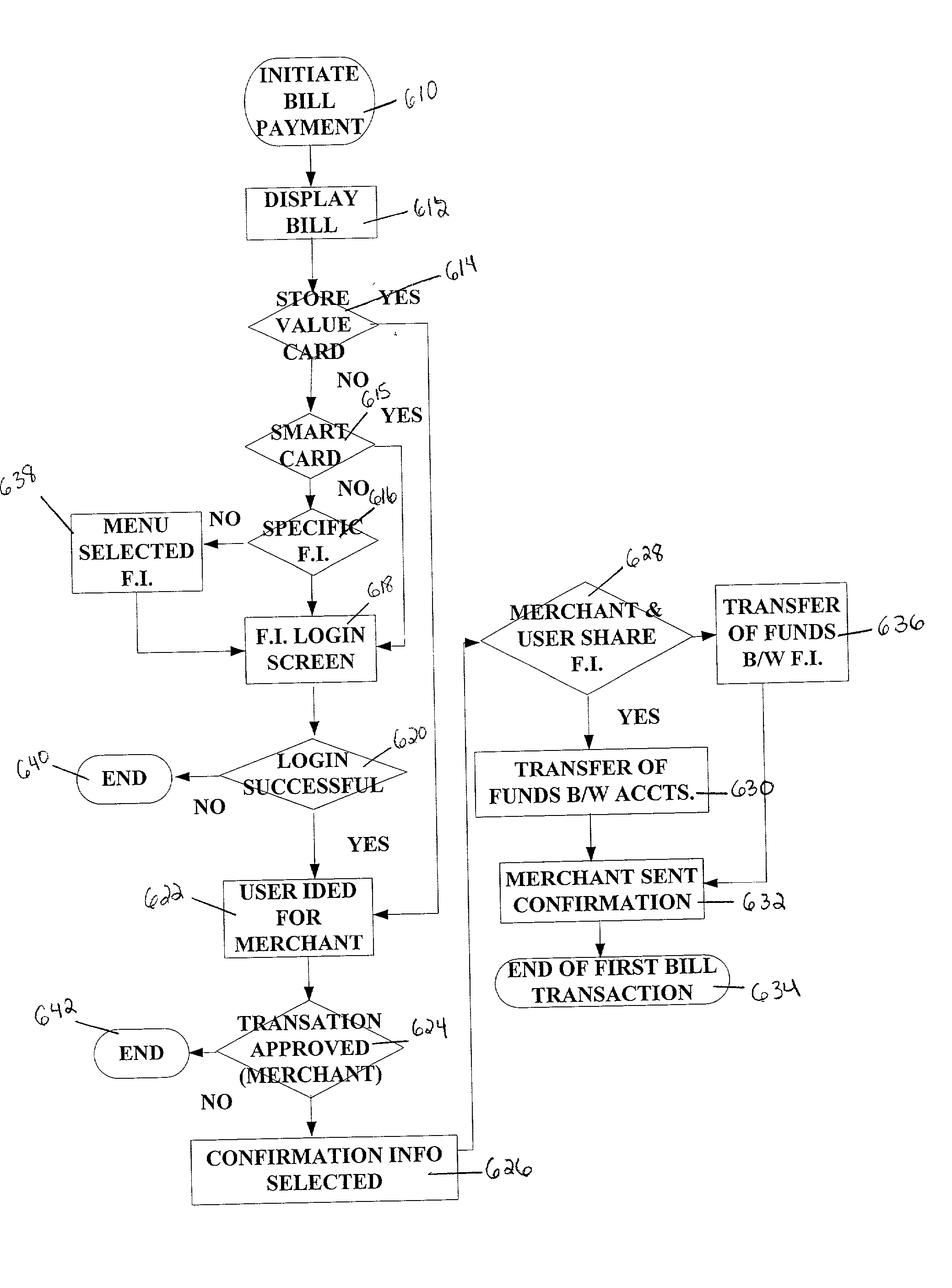

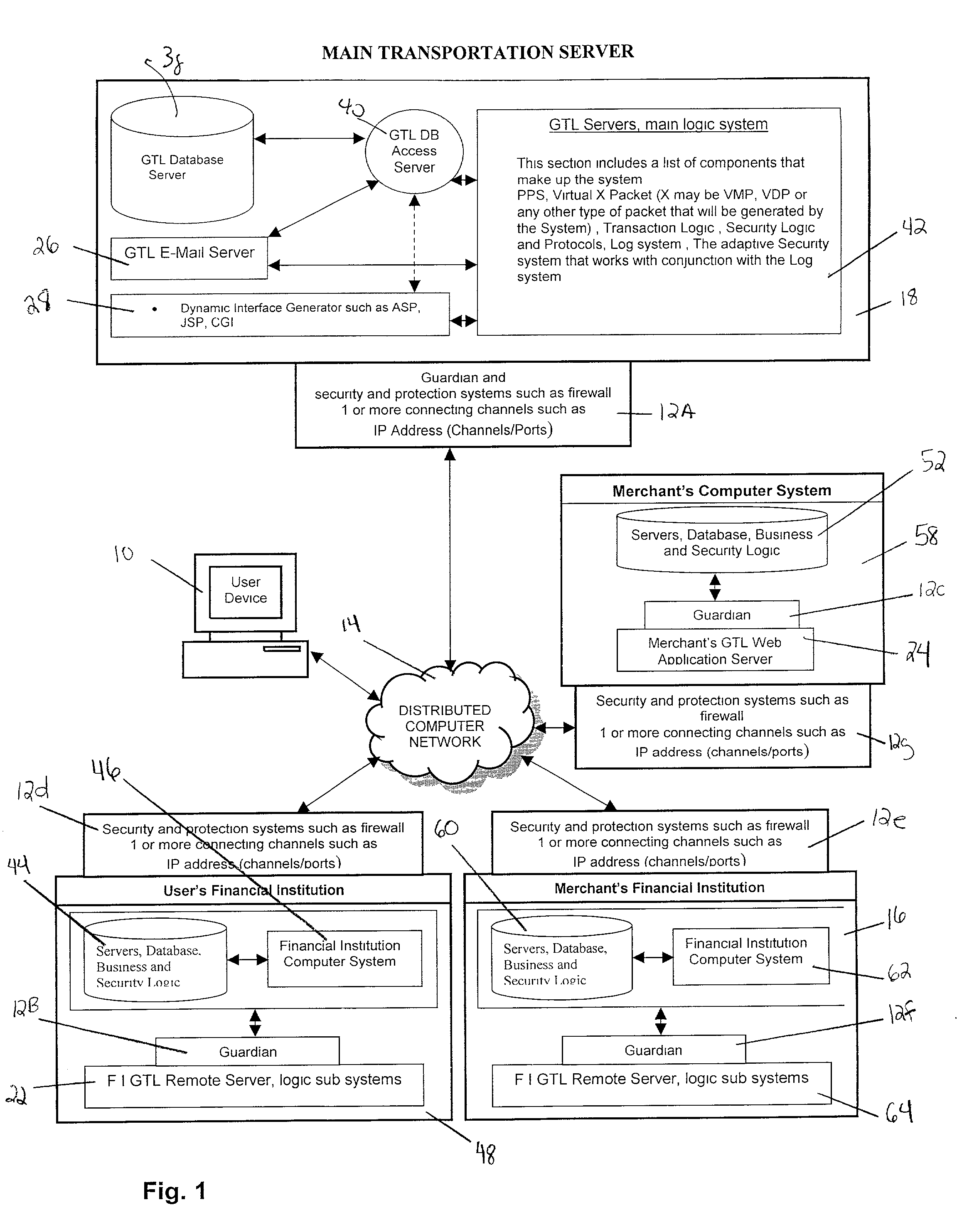

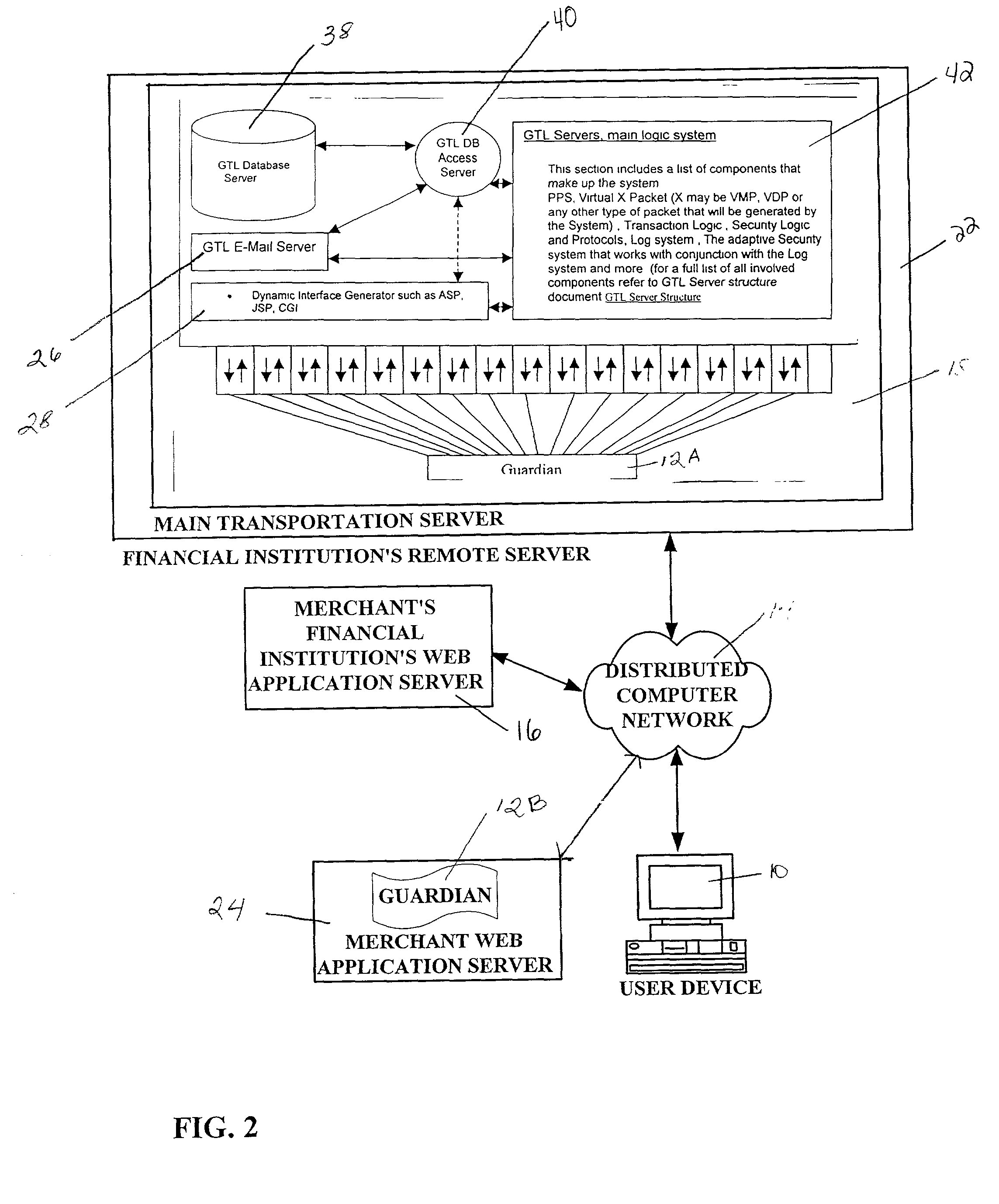

What is disclosed in this application is: an Internet payment system. An Internet payment system comprising a user device with a processor, Internet connection apparatus and an Internet browser. The Internet payment system also includes a participating merchant server supporting web pages on which product or service offerings are displayed in response to queries from the user device using the connections apparatus and browser. The merchant server interacting with the user device browser permits a user to select at least one offering and to indicate a method of payment, at least one method of payment being a transfer link. The Internet payment system also comprises a participating financial institution server maintained by a financial institution at which the user has a financial account. The server permits the user to gain direct access to his financial account. In addition, the Internet payment system includes a main transportation server to which both the user device and merchant server are connected in response to the user selecting the transfer link as the method of payment. The merchant server transmits information to the main transport server regarding payment required for the selected offering and the main transport server provides a selection of financial institutions from which the user can select an institute at which he has an account for payment for the offering. The main transport server transmits user inputs directly to the financial institution server to authorize payment to the merchant for the offering without storing the inputs.

Owner:MUNOZ FERNANDO

Method and apparatus for protecting communication of information through a graphical user interface

ActiveUS20060259873A1Internal/peripheral component protectionInput/output processes for data processingGraphicsGraphical user interface

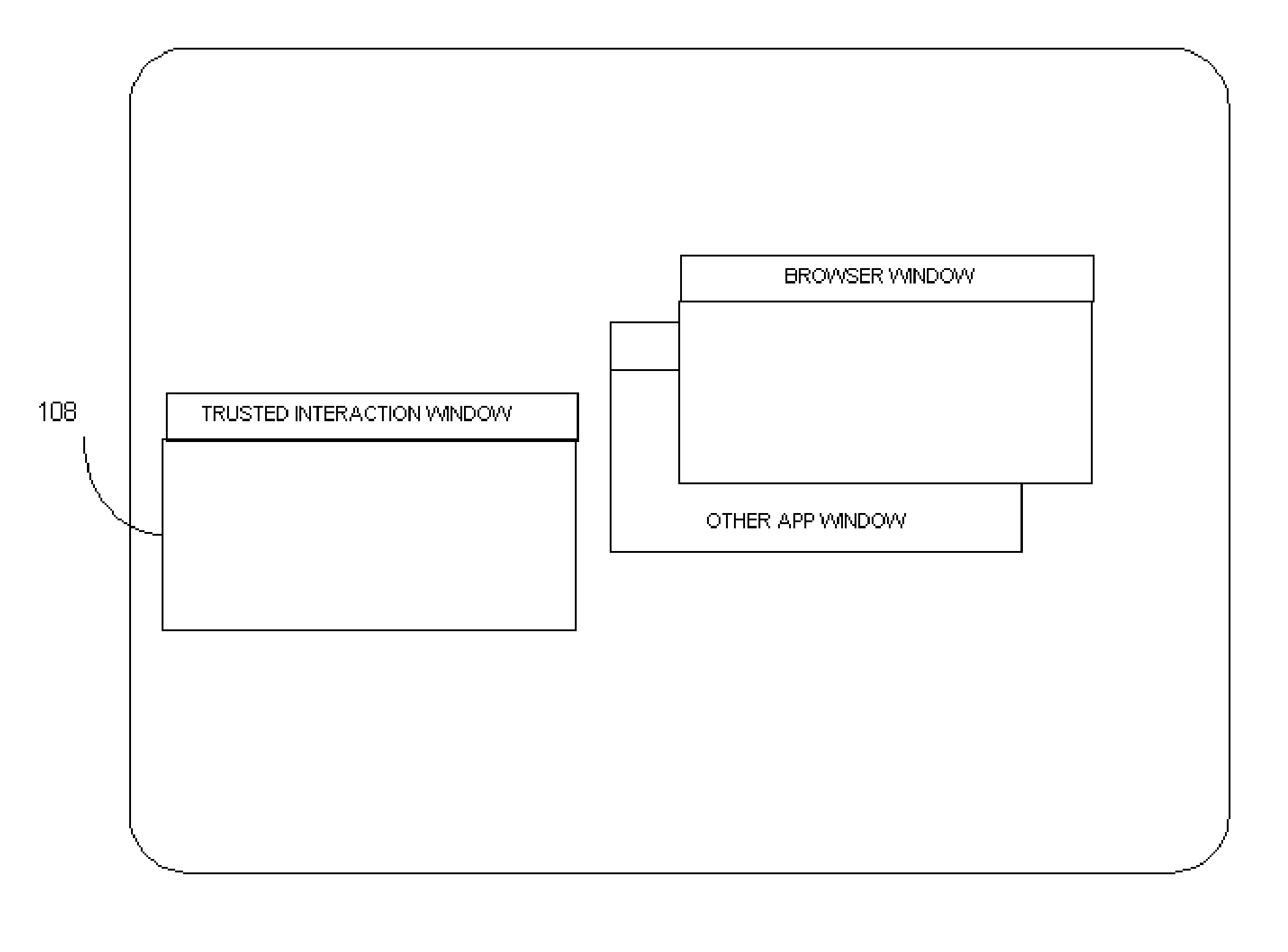

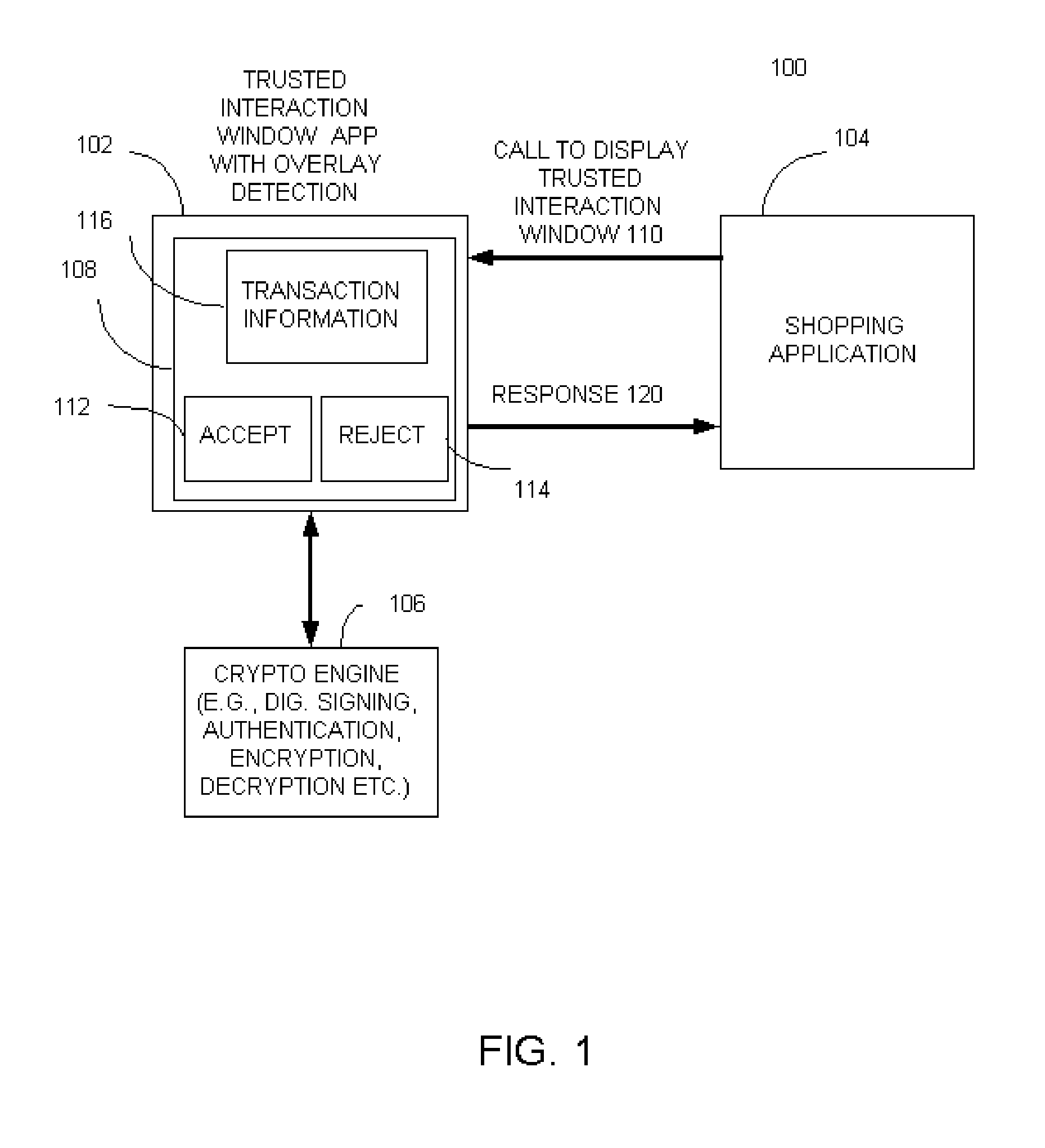

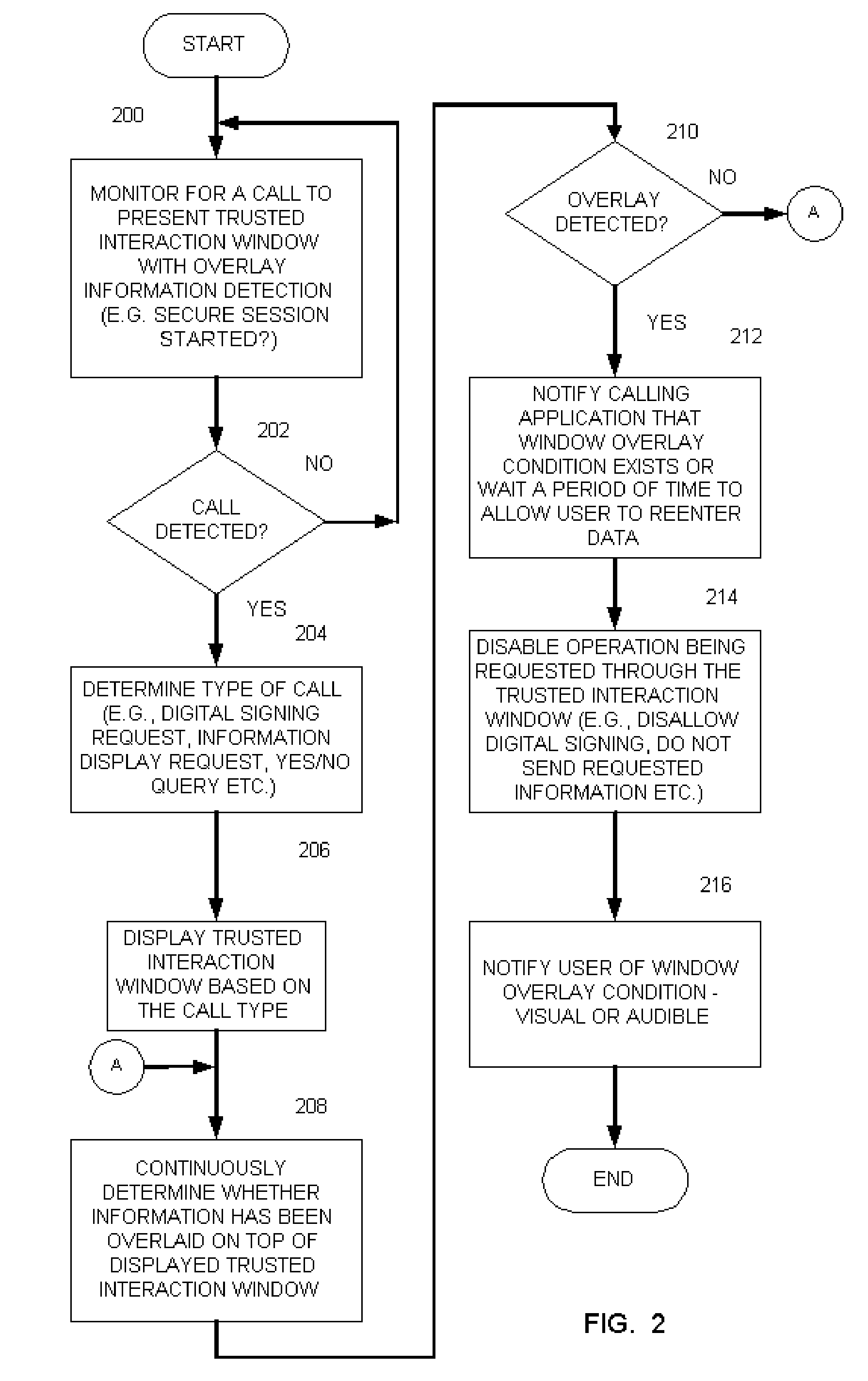

A method and apparatus for protecting communication of information through a graphical user interface displays a graphical user interface that includes a trusted interaction window. In one example, the method includes continuously determining whether information has been overlayed on top of at least a portion of the displayed trusted interaction window and then disabling an operation being requested when an overlay condition has been determined. In one example, the trusted interaction window is maintained to be the top most window when it is called by an application, for example, during an online transaction, or any other suitable action. The trusted interaction window may be generated via a browser, or operating system, or any other suitable application. As such, the trusted interaction window detects when another window is overlayed on top of it, such as a chromeless window, thereby preventing an unscrupulous party from tricking the user or obtaining sensitive information. A user may be notified via any suitable notification that the trusted interaction window has been overlayed so that the user may take the appropriate action if desired.

Owner:ENTRUST

Identification and management of fraudulent credit/debit card purchases at merchant ecommerce sites

InactiveUS20080046334A1Reduce exposureFinanceDigital data processing detailsE-commerceOnline trading

Transaction processing of online transactions at merchant sites determines the likelihood that such transactions are fraudulent, accounting for unreliable fields of a transaction order, which fields do not reliably identify a purchaser. A scoring server using statistical model uses multiple profiles associated with key fields, along with weights to indicate the degree to which the profiles identify the purchaser of the transaction.

Owner:FAIR ISAAC & CO INC

Online transaction hosting apparatus and method

InactiveUS20050289039A1Streamlining transaction costMaintaining anonymityFinanceCommercePaymentFinancial transaction

An invention is disclosed relating to an apparatus and method for hosting transactions over a network such as the Internet. Sellers post offers to sell under a listing belonging to an organized database of listings. Likewise, buyers post offers to buy. A matching module selects offers to sell and matches them to offers to buy based on a predefined criteria. Before posting offers to sell or buy, buyers and sellers may be presented with data concerning the market for the product that is the subject of the offer. A sale is consummated between the buyer and seller of the matched offer to buy and offer to sell. Consummation may include assessing the risk of fraud posed by the matched buyer and matched seller. Fees may be charged to the matched buyer, the matched seller, or both as insurance against fraud. Payment may be made by the buyer directly to the seller or to a host hosting the apparatus and method for conducting the transaction. Payment is forwarded to the seller by the host upon confirmation by the buyer that a product has been received in good order. An automated, or partially automated, dispute resolution process may resolve disputed transactions.

Owner:REVOLUTIONARY E COMMERCE SYST

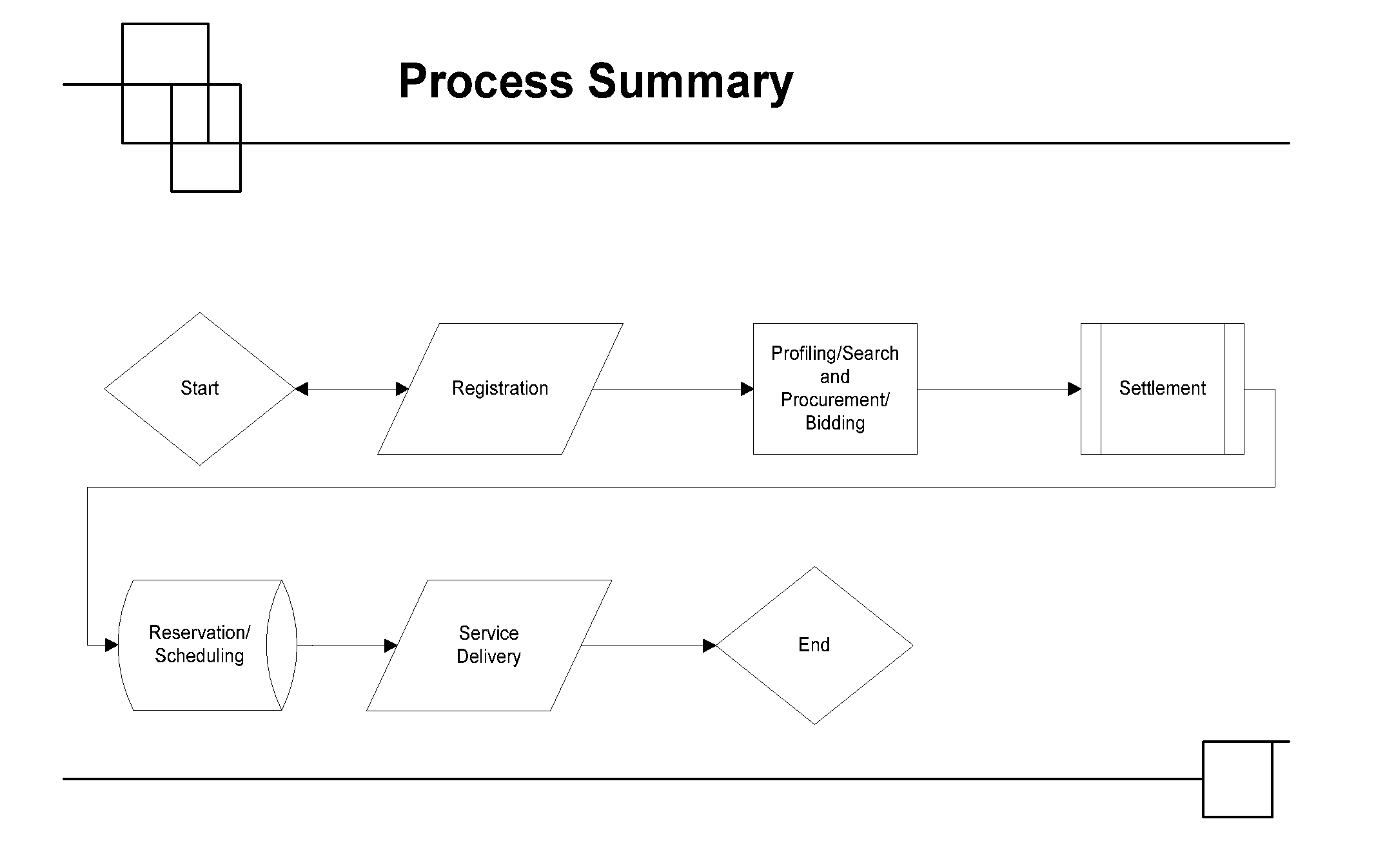

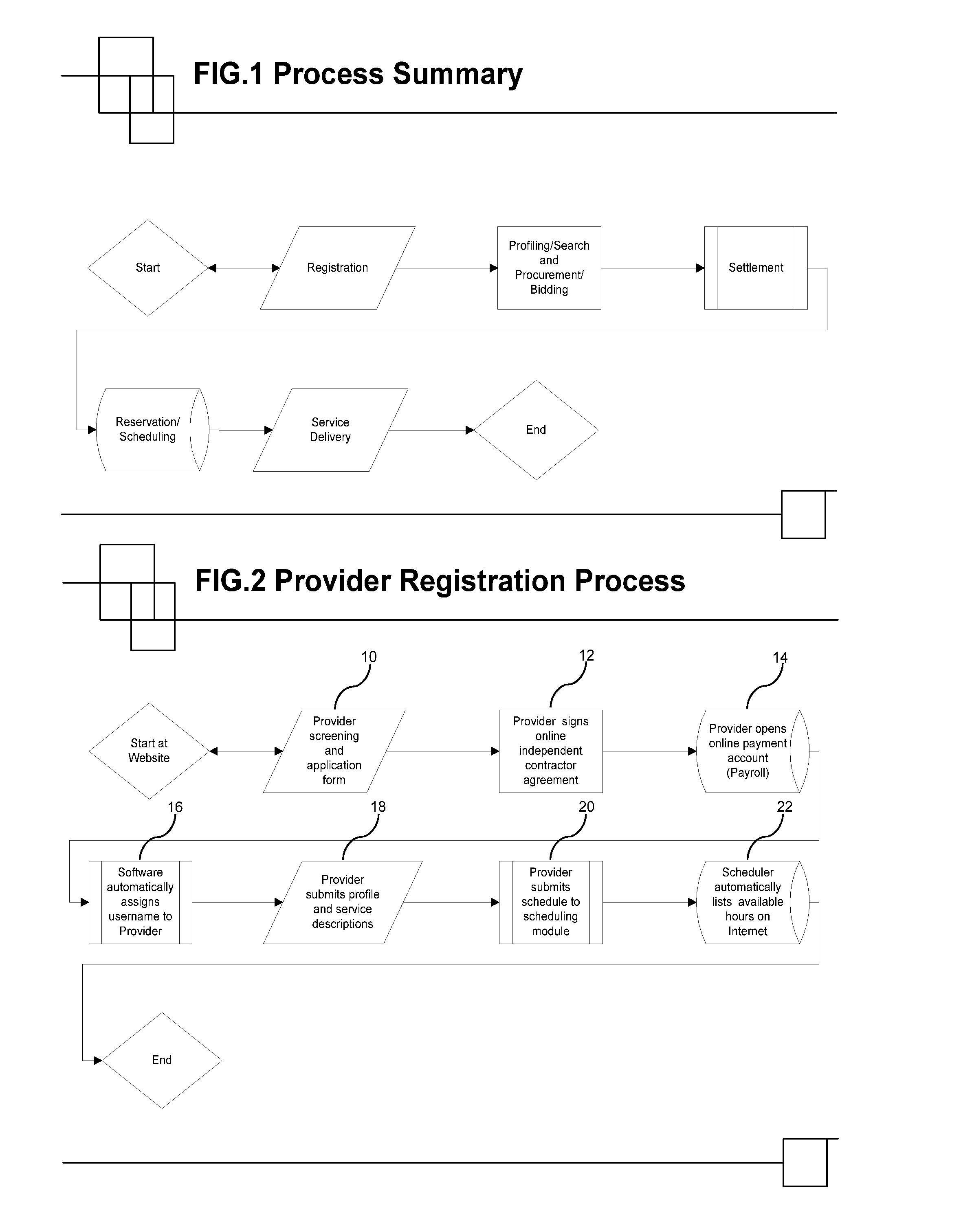

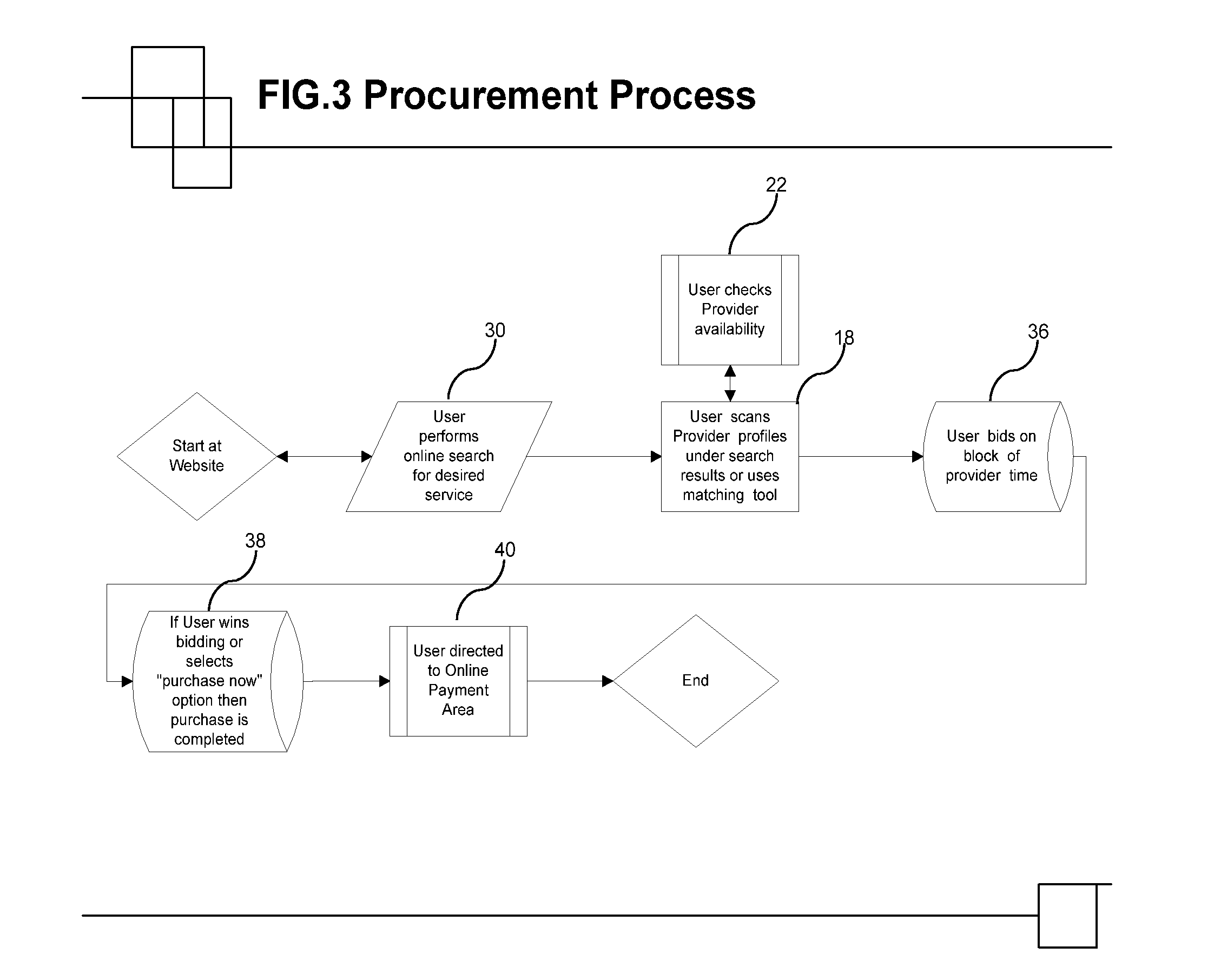

Real-time Professional Services Facilitator system and method

InactiveUS20060122850A1Facilitates real-time interactive sessionThe process is convenient and fastPayment architectureMarketingPaymentOnline trading

A method and system enabling users to access a plurality of professional service providers and knowledge experts to engage their services in real-time over the global computer networks and mobile phones. Prior to scheduling a session, the user has the option to bid on the services of a provider or expert in an online trading environment or to “purchase now” by making an instantaneous payment, or by subscription. The system and method enables sessions and events to be scheduled online and delivered via any combination of voice, video, and text over either a wired or wireless connection to the Internet, instant messaging applications, personal digital assistants, mobile phones, or any specialized communications device that can support interactive delivery of professional services and real-time solutions and guidance. The abovementioned interfaces over which the real-time professional services will be delivered are hereinafter collectively referred to as “Global Communications Networks.”

Owner:WARD MATEO DYLAN +2

Methods and Apparatus for Selling Shipping Services Through a Mediator's Web Site

ActiveUS20080162304A1Reasonable and competitive shipping costMore lenientLogisticsCommerceThird partyPayment

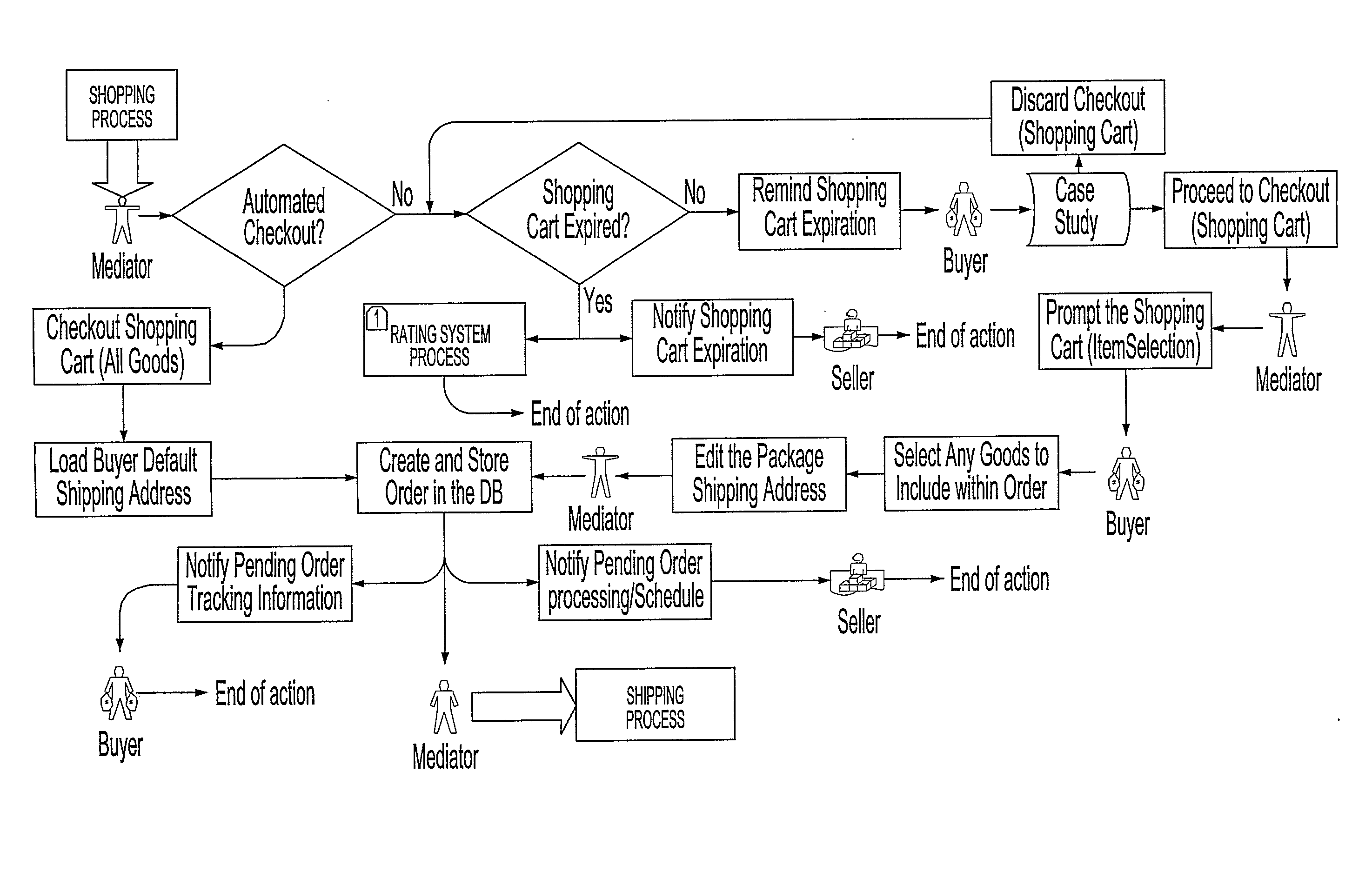

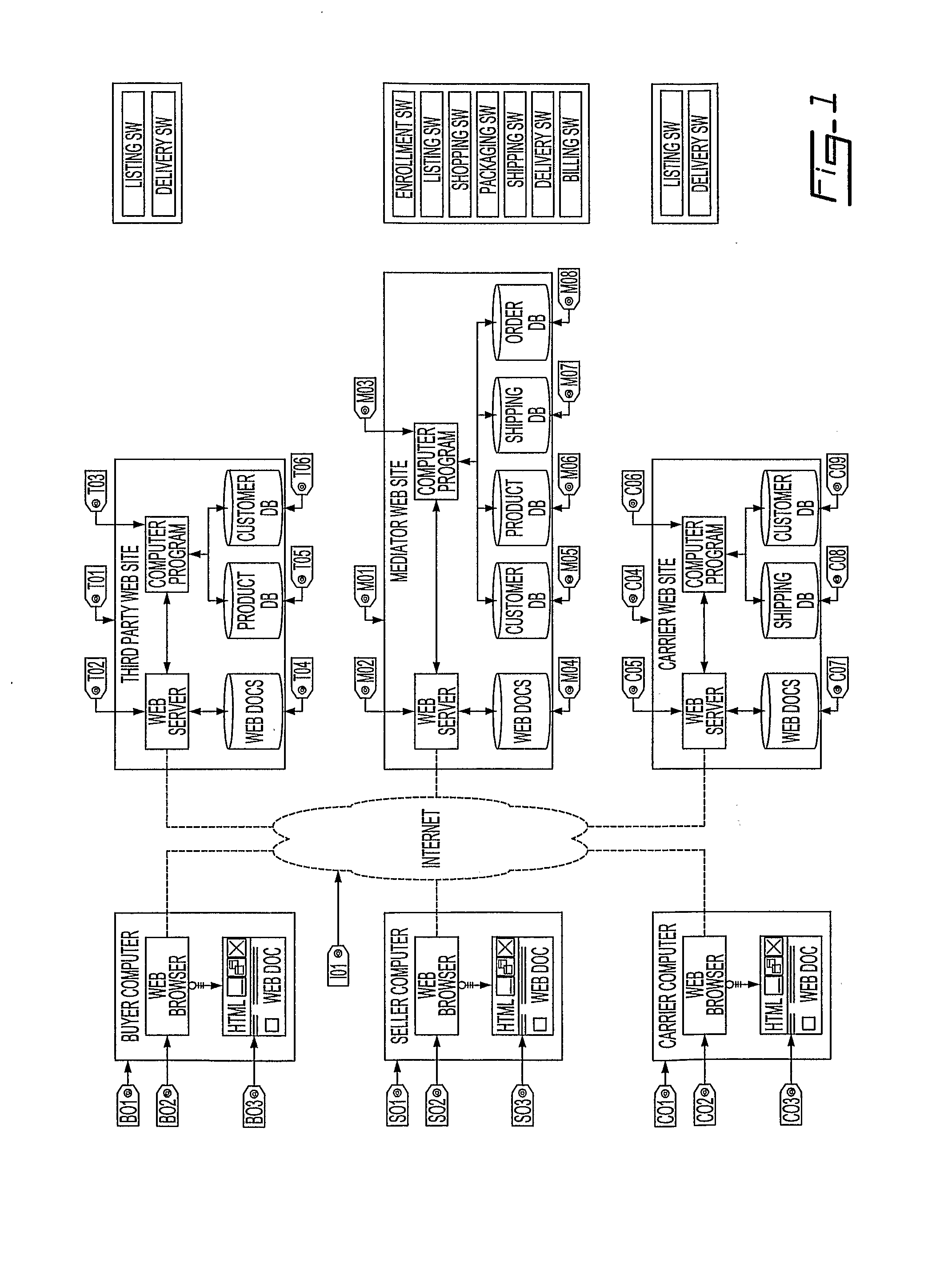

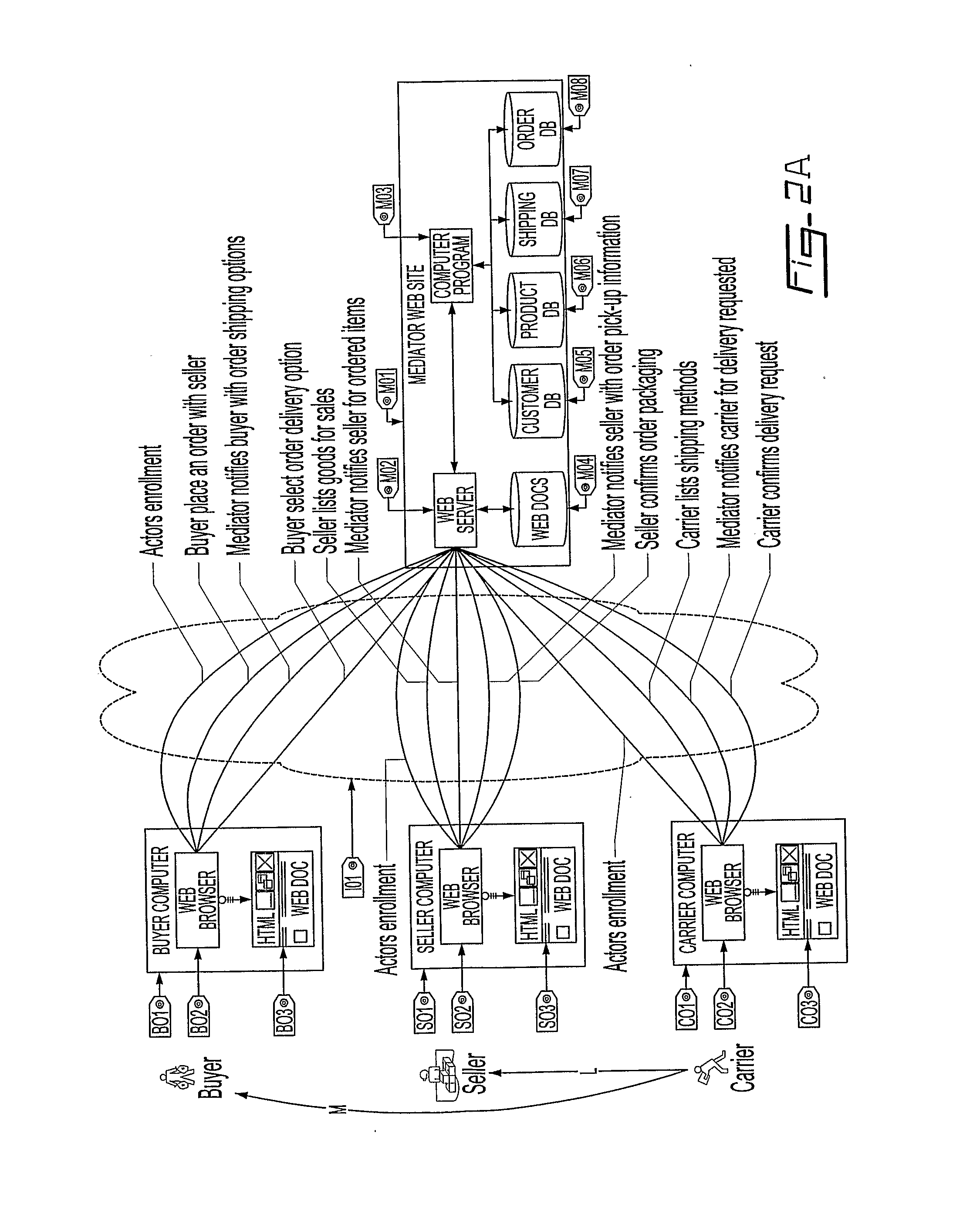

The present invention provides a method and an apparatus for enabling buyers, sellers and shipping companies (or carriers) to exchange goods, services and communications, through a system provided by a third party entity, referred to herein as the “mediator”. Particular to the present invention is to enable buyers to openly select their shipping method from an independent carrier to deliver goods purchased from sellers. This invention also enables sellers to relinquish their shipping operations to independent carriers to focus more on their core business. Finally, this invention enables carriers to bypass a seller of goods, as middleman, to openly promote their services to buyers. The system allows all these parties to interact using computing devices with Web browsing capability. The mediator provides an electronic trading platform wherein sellers register their goods for sale, and carriers publish their shipping methods and rate charts, for buyers to choose from. When a buyer places an order, the seller is required to confirm the received order along with the package characteristics, for example the package weight and dimensions, which are used to compute the shipping options available for this specific package from independent carriers. These computed shipping options are presented to the buyer, who then selects the delivery method that suits his needs. Subsequently, the selected carrier is contacted with the package shipping information, including the estimated shipping price that the carrier may agree with or adjust. When a shipping agreement is reached, the system automatically schedules the package pickup and delivery dates and notifies all the parties involved. The buyer makes a payment to the mediator, as a clearinghouse, for the purchased goods and shipping costs. Subsequently at the scheduled pickup date, the carrier visits the seller to take the package and delivers it using the shipping method selected by the buyer. When the package is delivery, the seller is credited for the goods sold, while a credit is issued to the carrier for the shipping costs. The mediator also charges commission fees to both the seller of goods and the carrier for facilitated transactions.

Owner:SHOPMEDIA

Online incremental payment method

According to the invention, a process for transferring funds between a payor and a payee in an online transaction is disclosed. In one step, information is received from the payor for debiting a bank account associated with the payor. Authorization is transmitted to the payee to request debits from the payor. The total of all debit requests does not exceed an amount that is authorized. A first request is received from the payee to debit the customer a first portion of the amount. A first debit is initiated from the bank account for the first portion of the amount. A second request is received from the payee to debit the payor a second portion of the amount. A second debit is initiated from the bank account for the second portion of the amount.

Owner:FIRST DATA

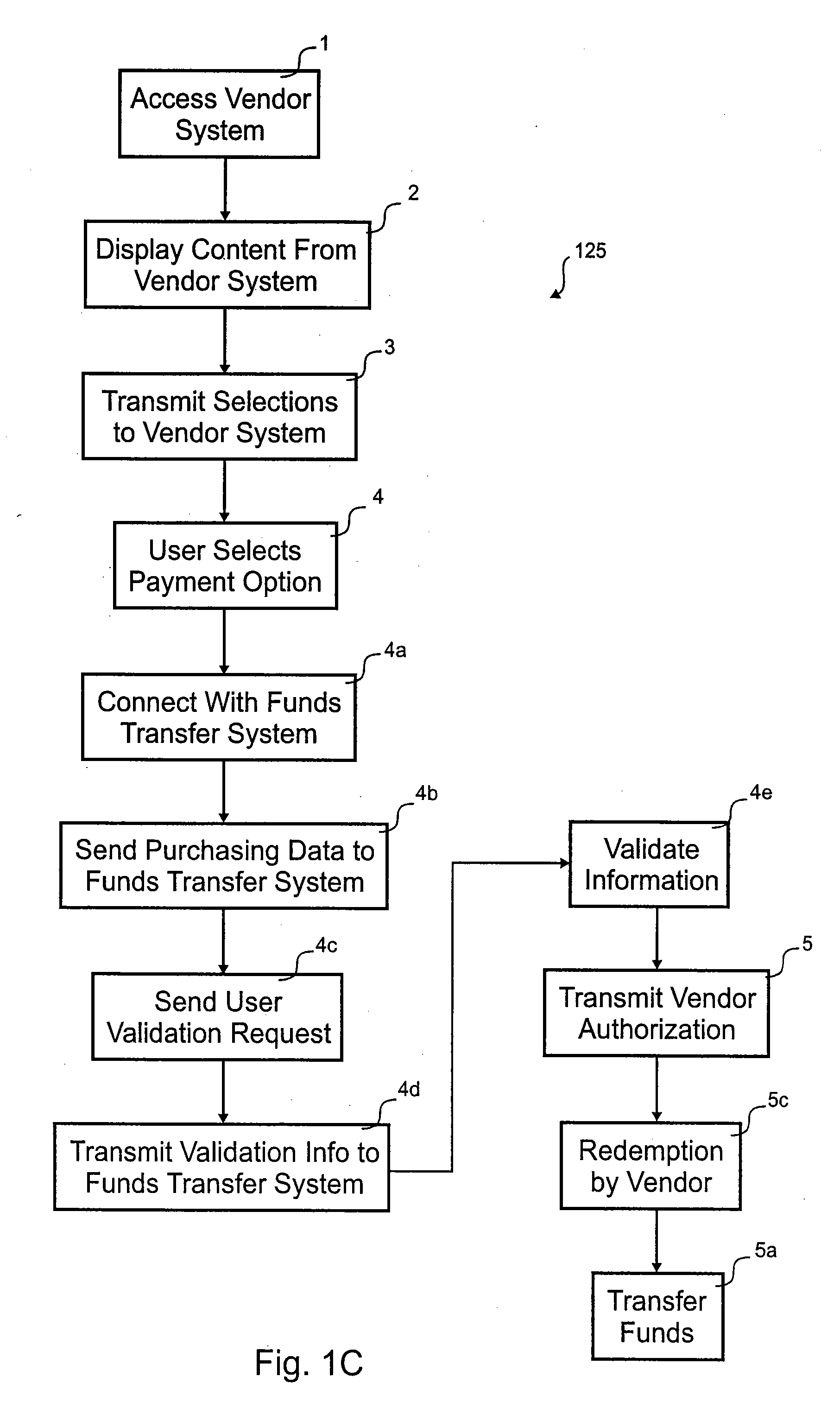

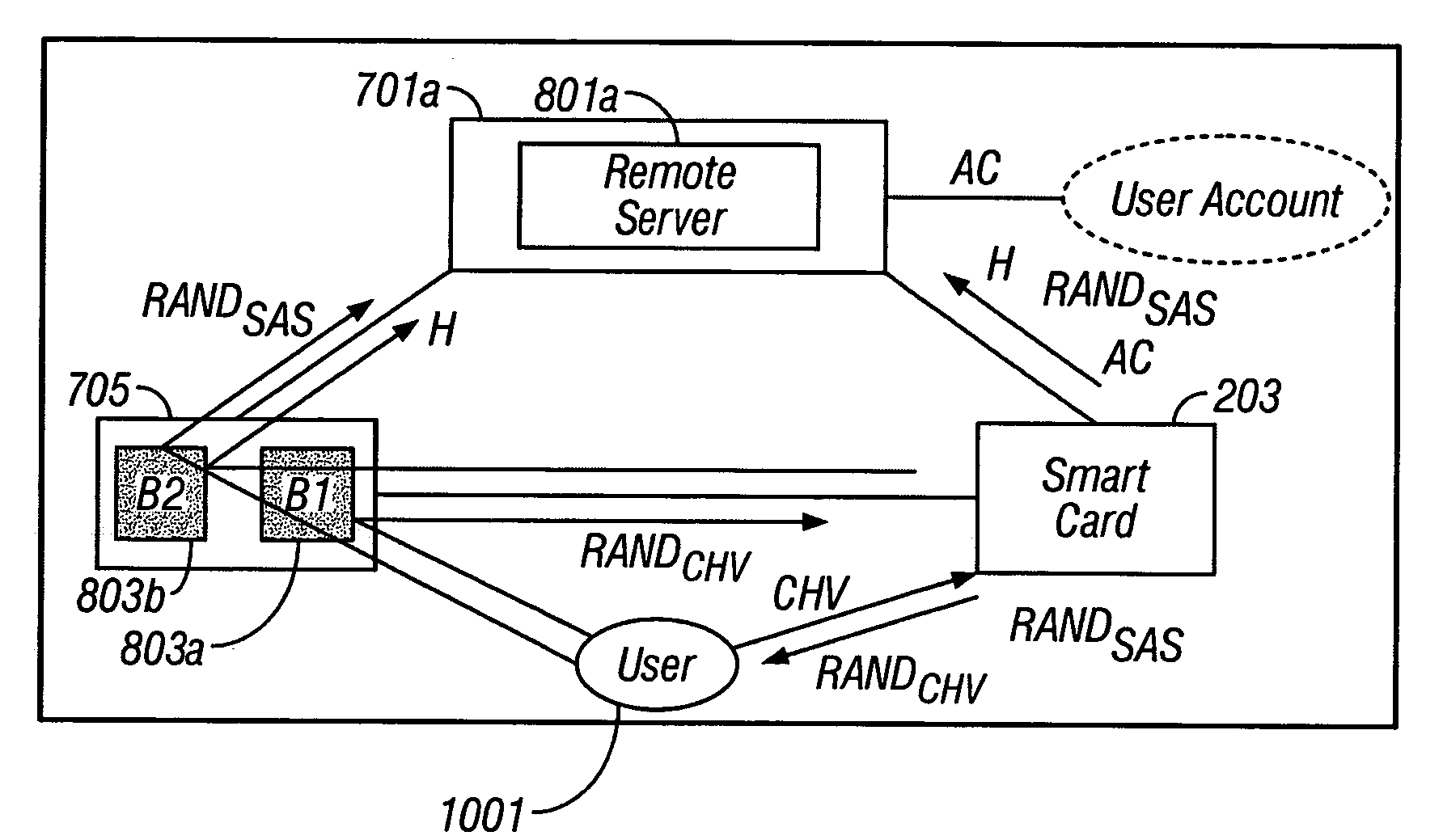

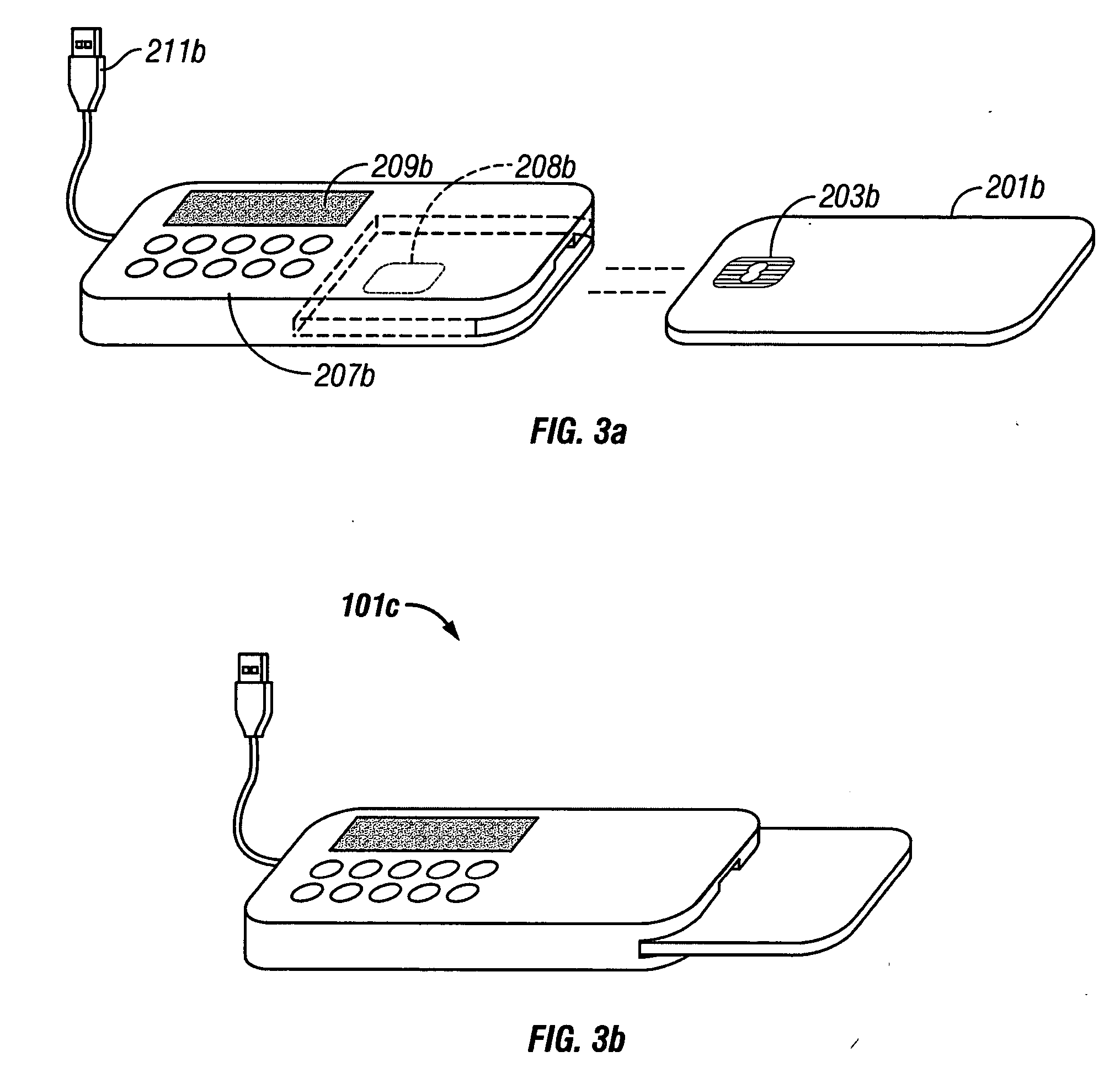

System and method for secure online transactions using portable secure network devices

InactiveUS20060294023A1Prevent online identity theftPrevent theftPayment architectureDigital data authenticationIdentity theftSmart card

A portable secure network device and method to operate such a device to provide secure login, secure online transactions, and to prevent online identity theft. An embodiment of the invention may be constructed by inserting a network smart card into a card reader, wherein either the card reader or the card itself has an output device and input device wherein the processor is programmed to execute according to instructions to cause the microprocessor: to produce a shared association secret; to display the shared association secret on the output device; and to transmit the shared association secret to the remote server; thereby ensuring that a user observing the output device and the remote server computer both possess the shared association secret.

Owner:AXALTO INC

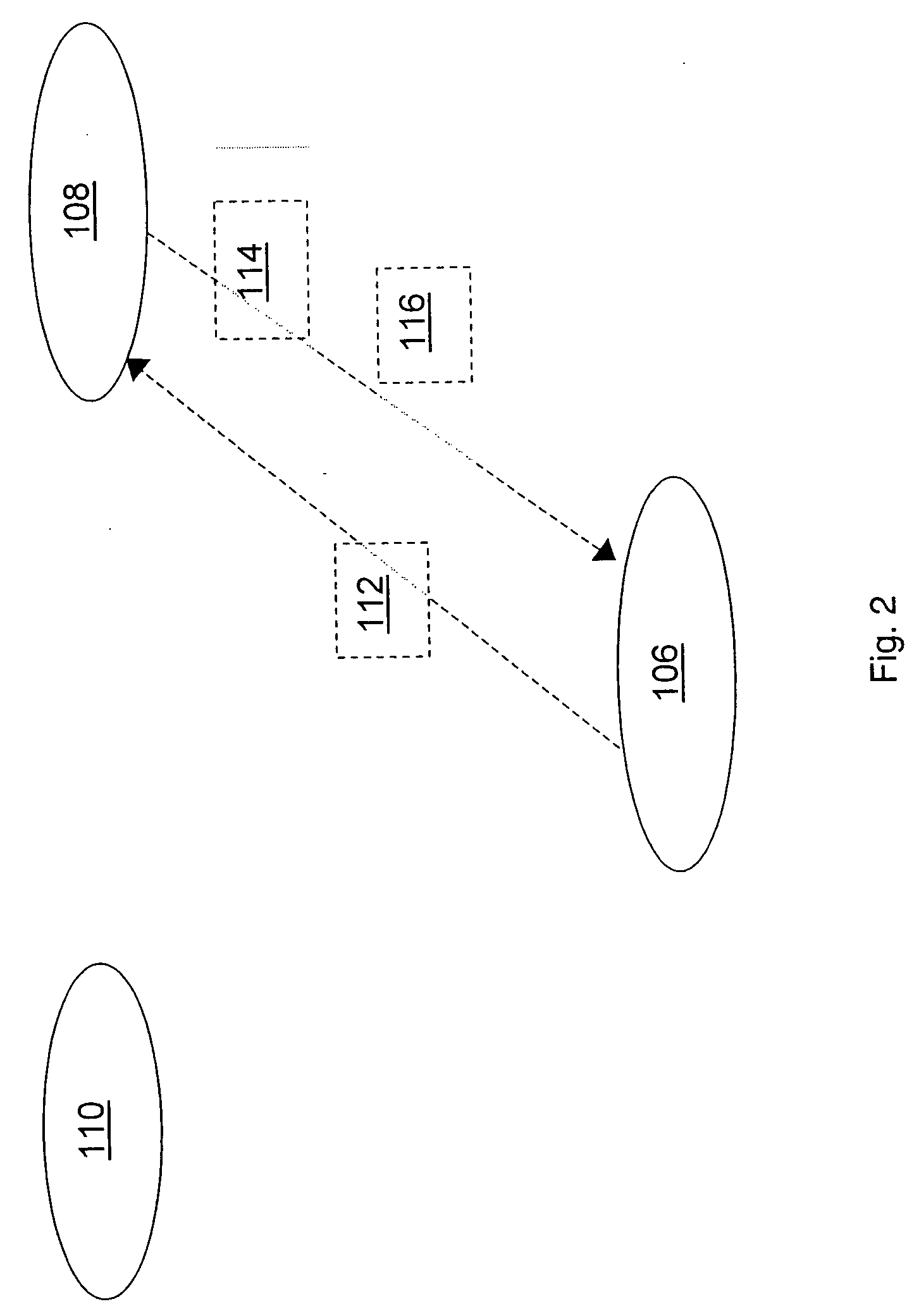

Authorisation system

InactiveUS20050262026A1More securityEasy constructionDigital data processing detailsSpecial data processing applicationsHash functionTime limit

Systems and methods for securely authorising an on-line transaction, e.g. involving a micro-payment, between a customer browser and merchant server without the need for special software installed on the customer computer or a SSL connection to the merchant server. The authorisation method involves a double redirection instruction: the initial transaction request is redirected via the customer web browser to a service provider arranged to authenticate the customer, from where the authenticated instruction is further redirected via the customer web browser to a merchant site to complete the transaction. Information identifying the merchant, merchandise, etc. is included in the redirection instruction, and may be encrypted or encoded e.g. using a hash function to prevent tampering. To authorise an authenticated instruction, a cookie containing transaction identification data may be returned to the merchant web server along with the authenticated instruction. Alternatively, the service provider may set a time limit after which the authenticated instruction will no longer be valid.

Owner:WATKINS DANIEL ROBERT

Process and method for secure online transactions with calculated risk and against fraud

InactiveUS20030120615A1Effectively combat fraudAlleviates payment card abuseComputer security arrangementsBuying/selling/leasing transactionsE-commercePayment card number

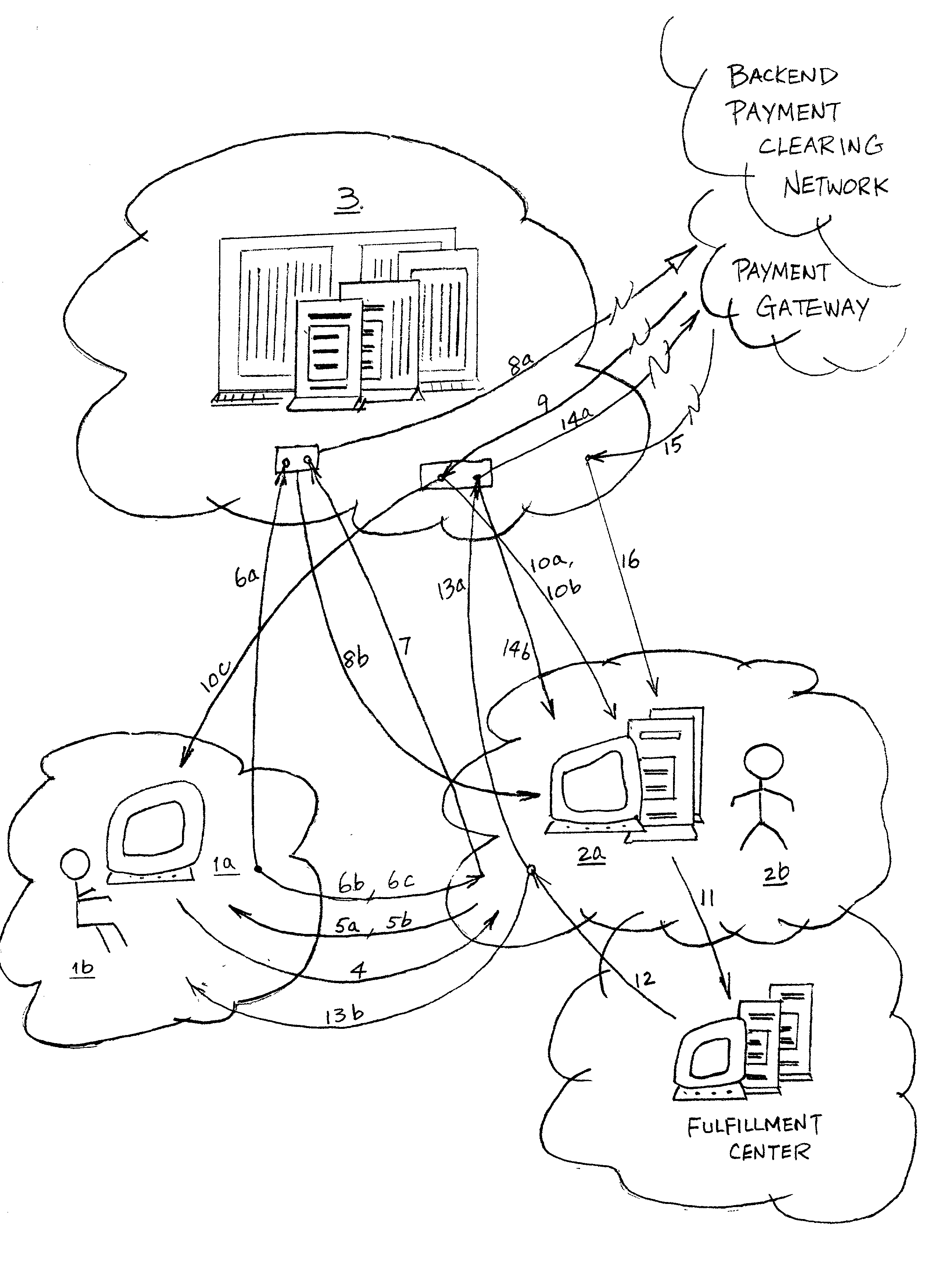

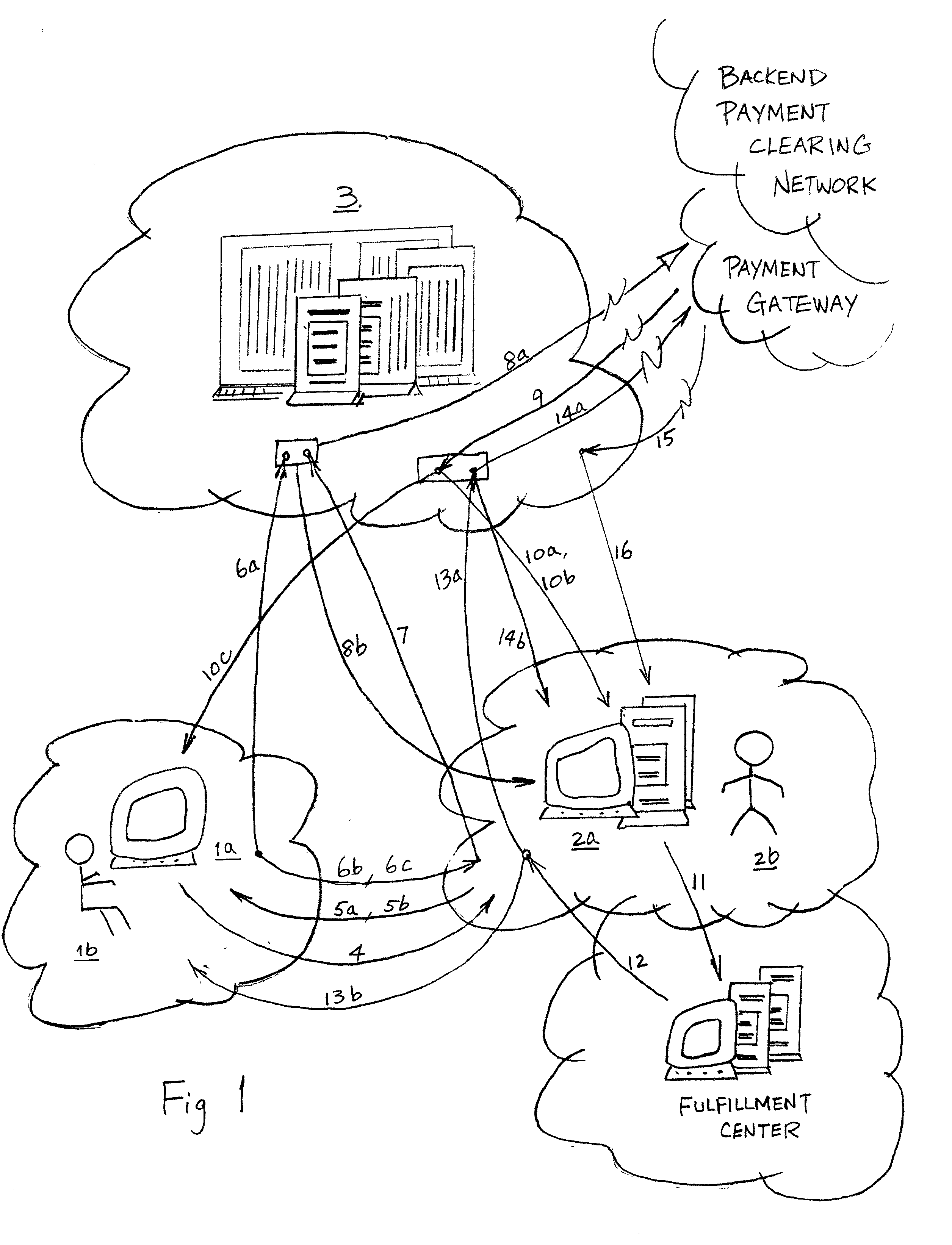

An electronic commerce process that facilitates online transactions among multiple participants, that prevents consumer fraud due to pirated payment card numbers, with calculated risk, involving at least one trusted payment card host (3), where buyer's payment card number is registered and corresponding secret keys are set up. The buyer (1b) initiates an online transaction by selecting a host from a list of hosts that served by the seller's web server (2a). Then, the buyer participant (1a) sends an order online (4), SSL encrypted. The seller participant (2a) receives and decrypts the order, confirms the availability of ordered items, assigns an orderID to the order, and sends a response (5a), SSL encrypted, to the buyer participant (1a) with the assigned orderID. The buyer participant (1a) encrypts and notifies the selected host (3) of this order and orderID, and authorizes the payment (6a) using secret keys. At the same time, the seller participant also encrypts and sends payment approval request (7) for this orderID through the host. The host (3) decrypts and matches up the orderID, retrieves the secret keys, and hashes to obtain the corresponding payment card number. The host then encrypts and send for payment authorization (8a) from the payment card issuer with the payment card number, through payment clearing network. Upon receiving and decrypting the response (9) back from the payment card issuer, the host (3) encrypts and notifies (10a) the seller participant (2a) of the card issuer's response (9) for the orderID. After fulfilling the order (11,12), the seller participant encrypts and sends for payment capturing (13a) for this order with orderID, through the host and payment network (14a,15,16).

Owner:ONLINE SECURITY PORTFOLIO

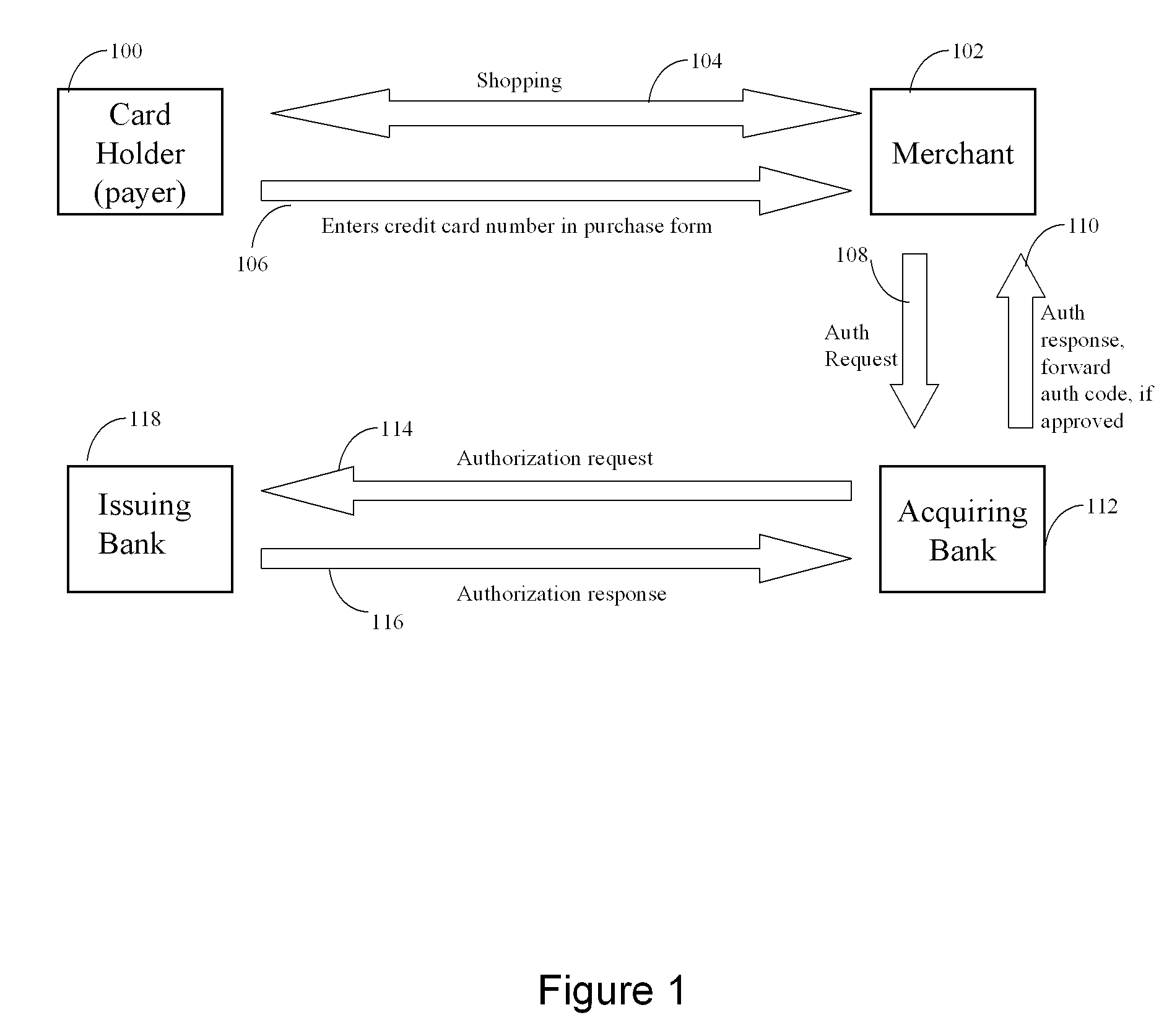

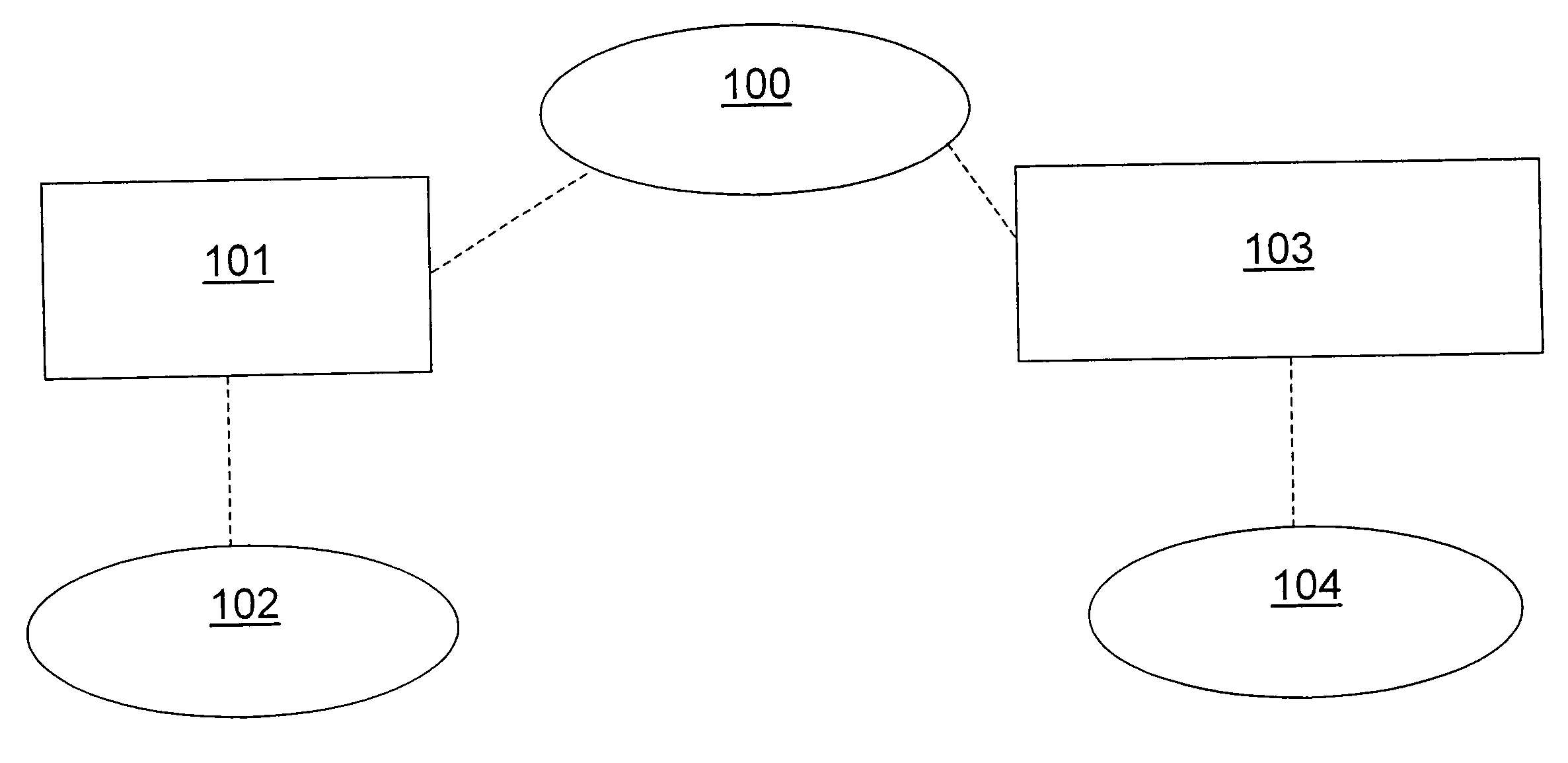

Method and apparatus for network transactions

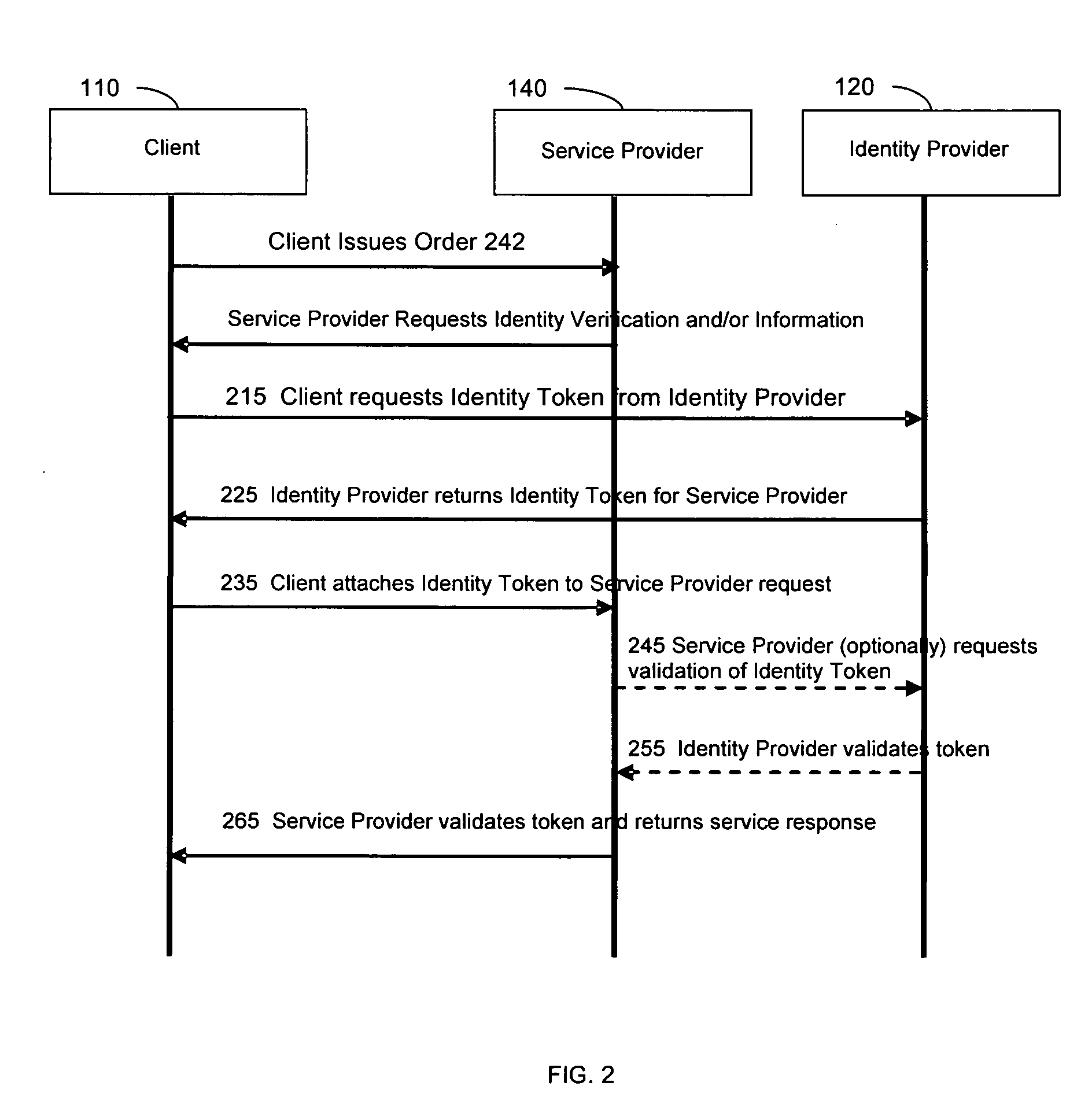

InactiveUS20060235761A1Reduce the burden onSimpler and more secure online commercial transactions frameworkFinanceDigital data processing detailsPaymentIdentity provider

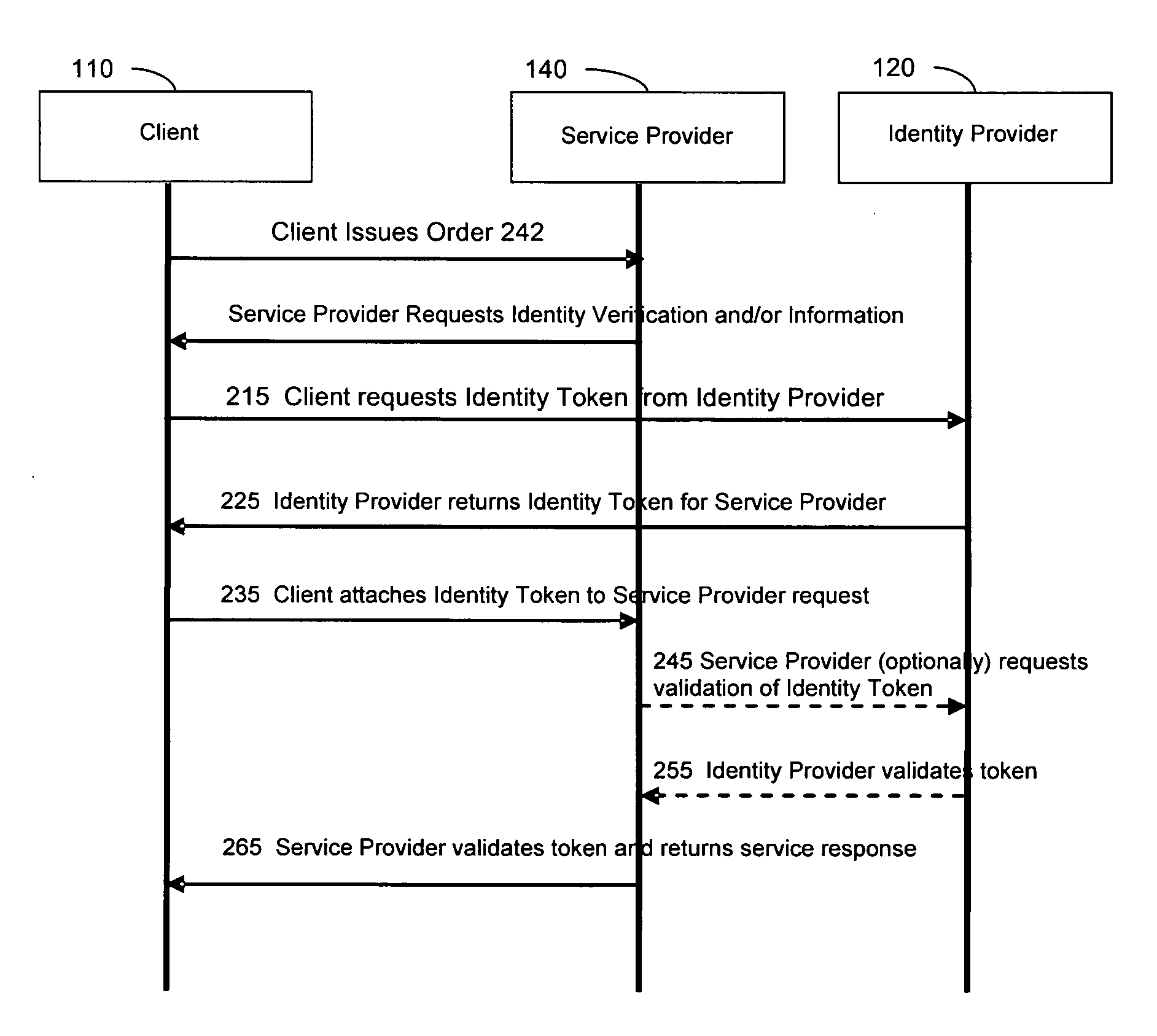

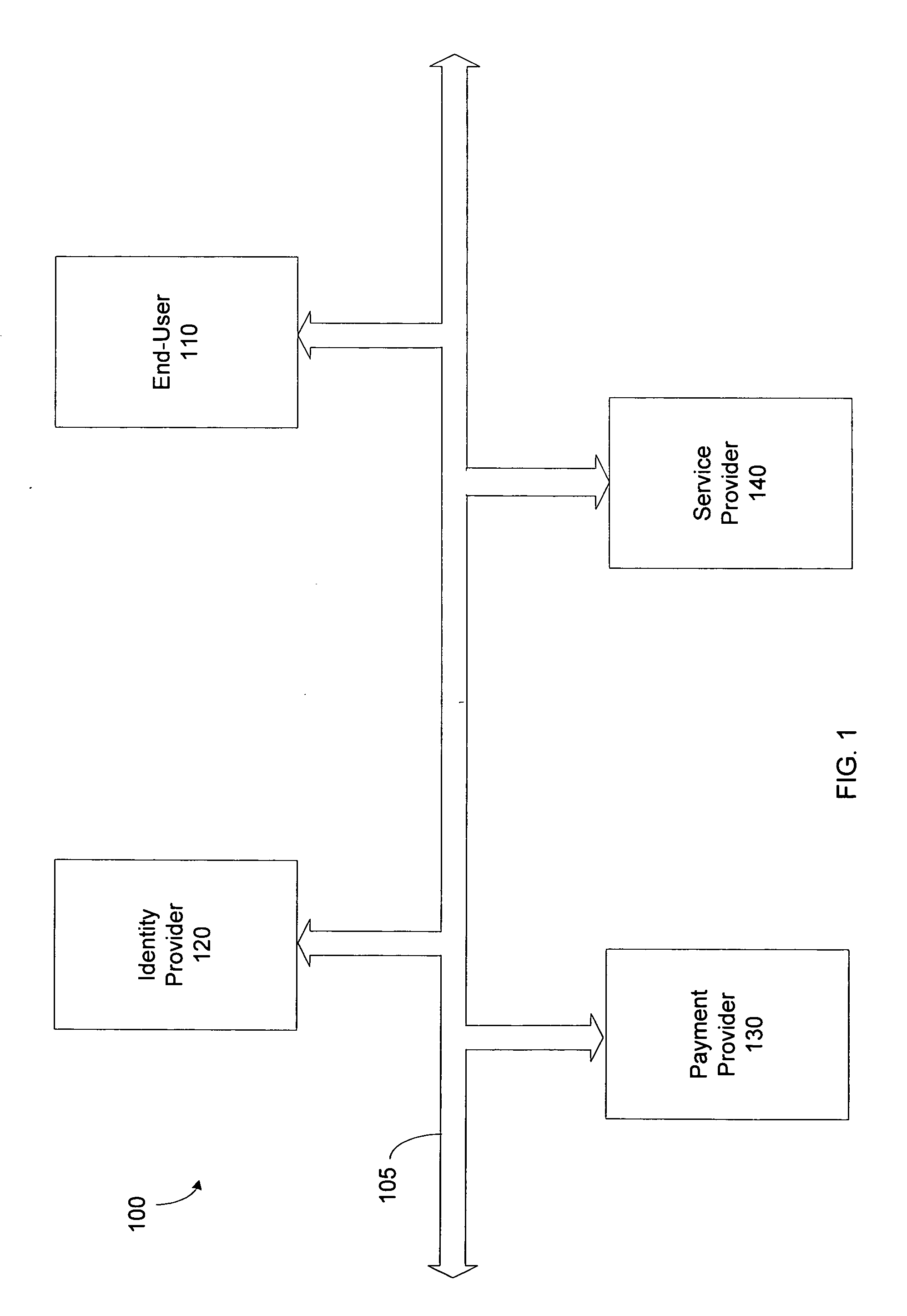

A method is provided to authorize an online transaction between a purchaser and a merchant. The method includes providing, via an identity provider, verification of an identity of the purchaser. The method also includes providing, via a payment provider, verification of an ability of the purchaser to pay for the transaction, where the identity provider and the payment provider are different network entities. A computer system is also provided that can conduct an online transaction between a purchaser and a merchant providing one or more goods and / or services. The computer system includes a first node configured to provide verification of an identity of the purchaser, and a second node configured to provide verification of an ability of the purchaser to pay for the transaction, where the first node and the second node are associated with different network entities.

Owner:MICROSOFT TECH LICENSING LLC

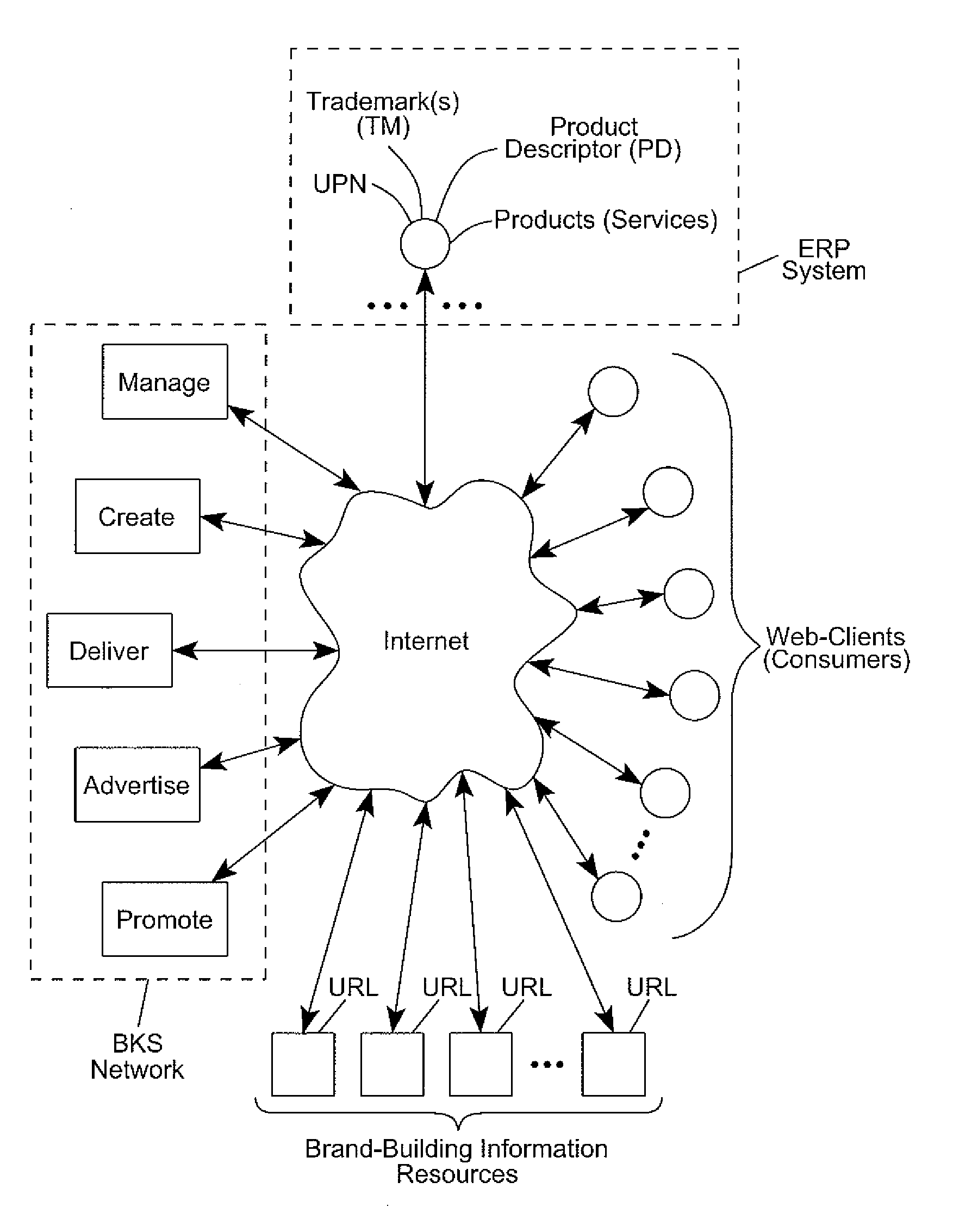

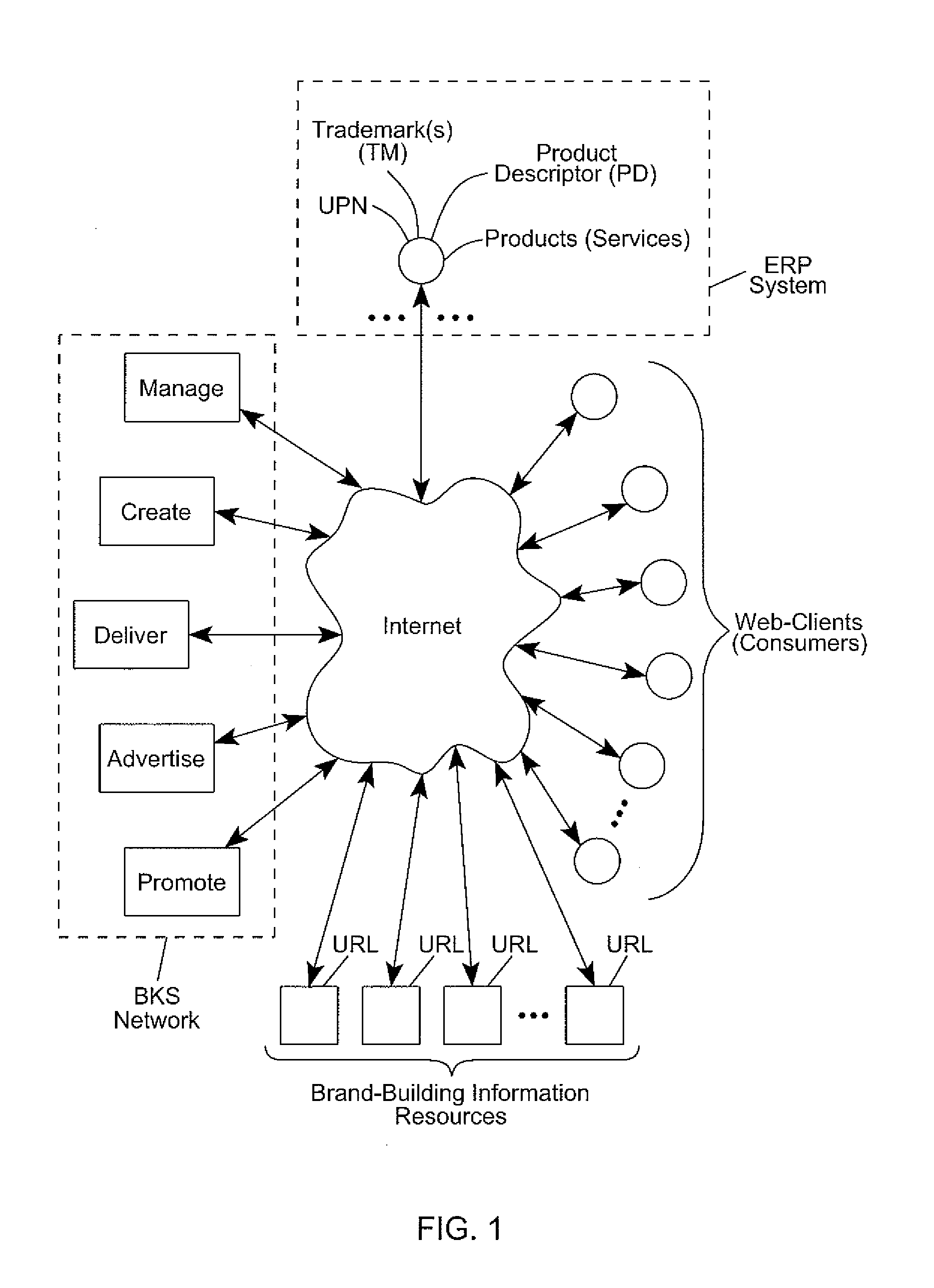

Inernet-based brand marketing communication network for enabling commission-based e-commerce transactions along the fabric of the world wide web (WWW) using server-side driven multi-mode virtual kiosks (MMVKs)

Internet-based Enterprise-Level Brand Management And Marketing Communication Network based on an innovative brand command, control and communication architecture (BC3), which gives brand owners complete command and control over the wide range of brand-building assets, messaging and promotions scattered throughout the Web, and how they are communicated to directly consumers at diverse Web touch points, with the efficiency and automation of supply-chain management solutions. The Network supports the deployment, installation and remote programming of brand-building server-side driven Multi-Mode Virtual Kiosks on the World Wide Web (WWW), and provide brand managers, their agents and online trading partners the power to build stronger online brands, drive sales and eliminate existing friction in the retail chain through a collaborative carrier-class, indutrial-strength e-marketing communication network.

Owner:BKS NETWORKS

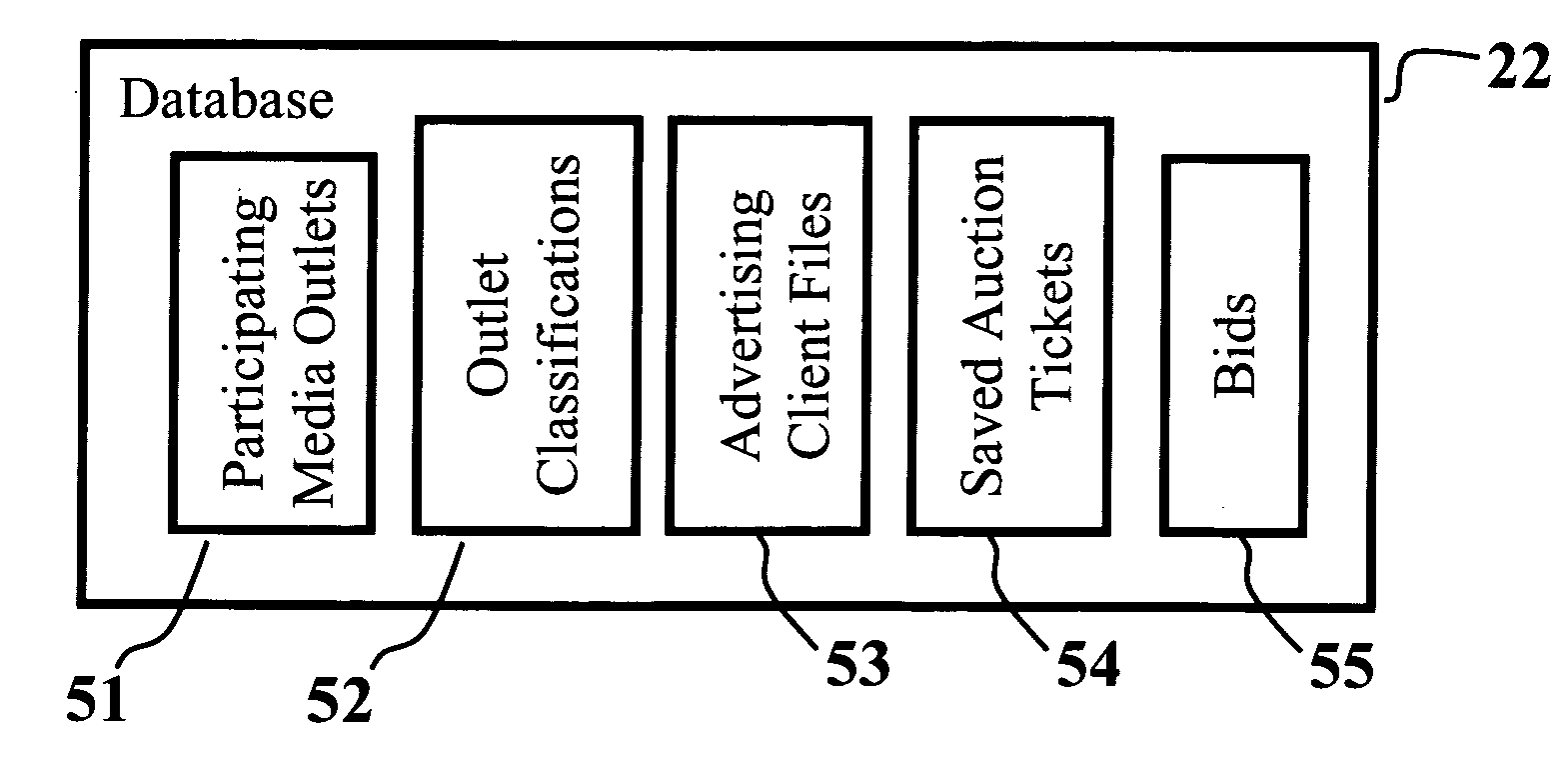

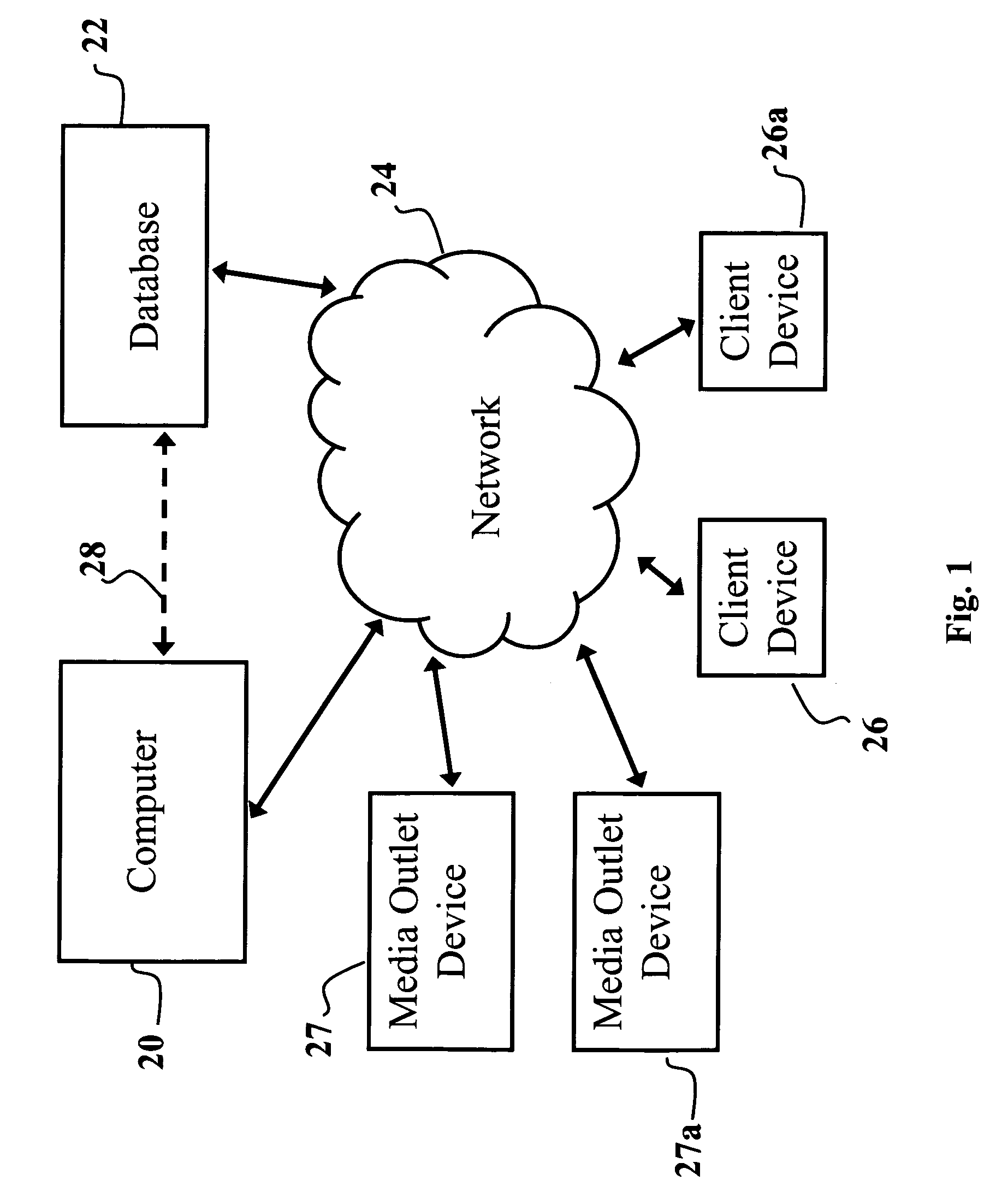

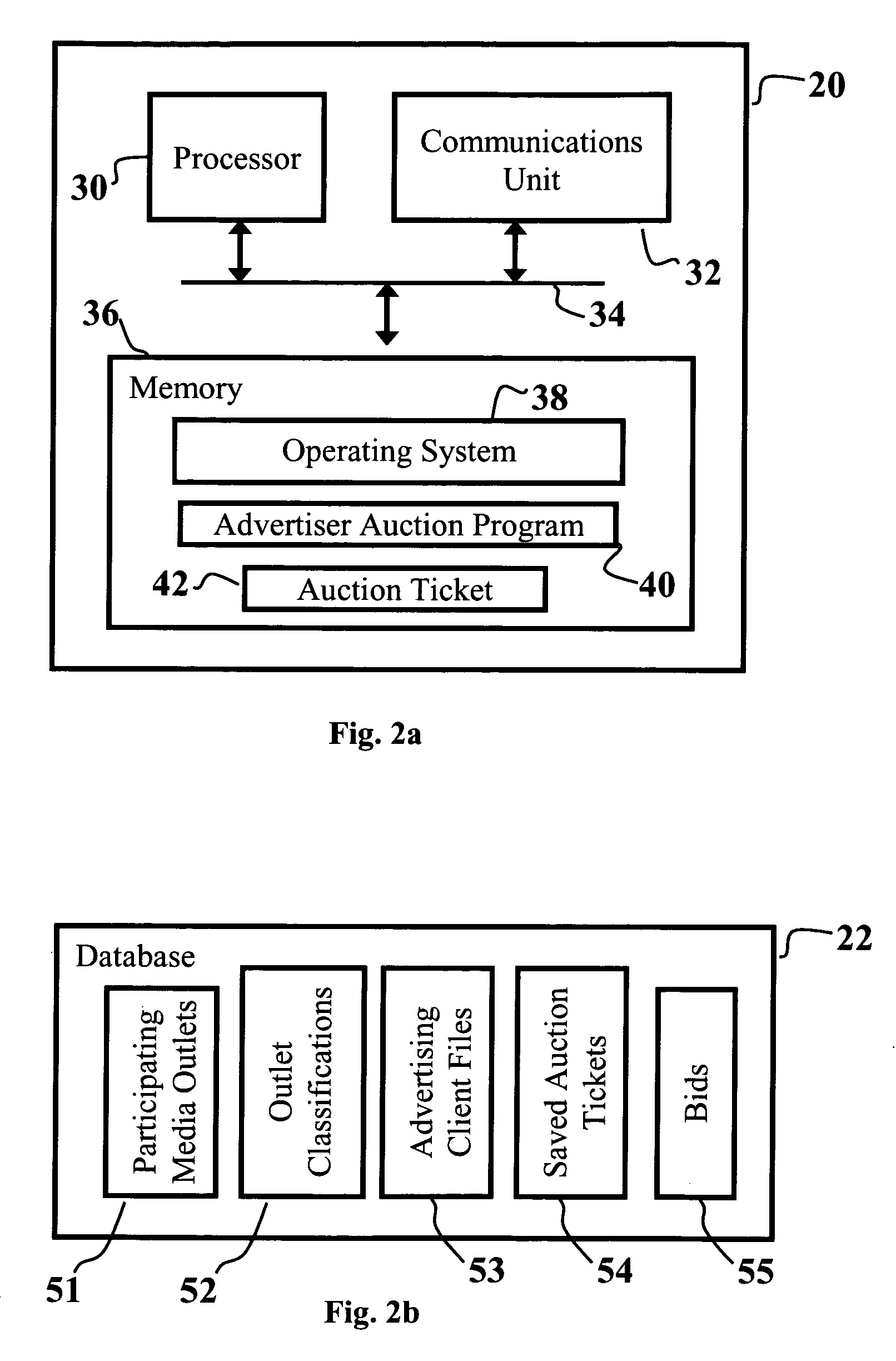

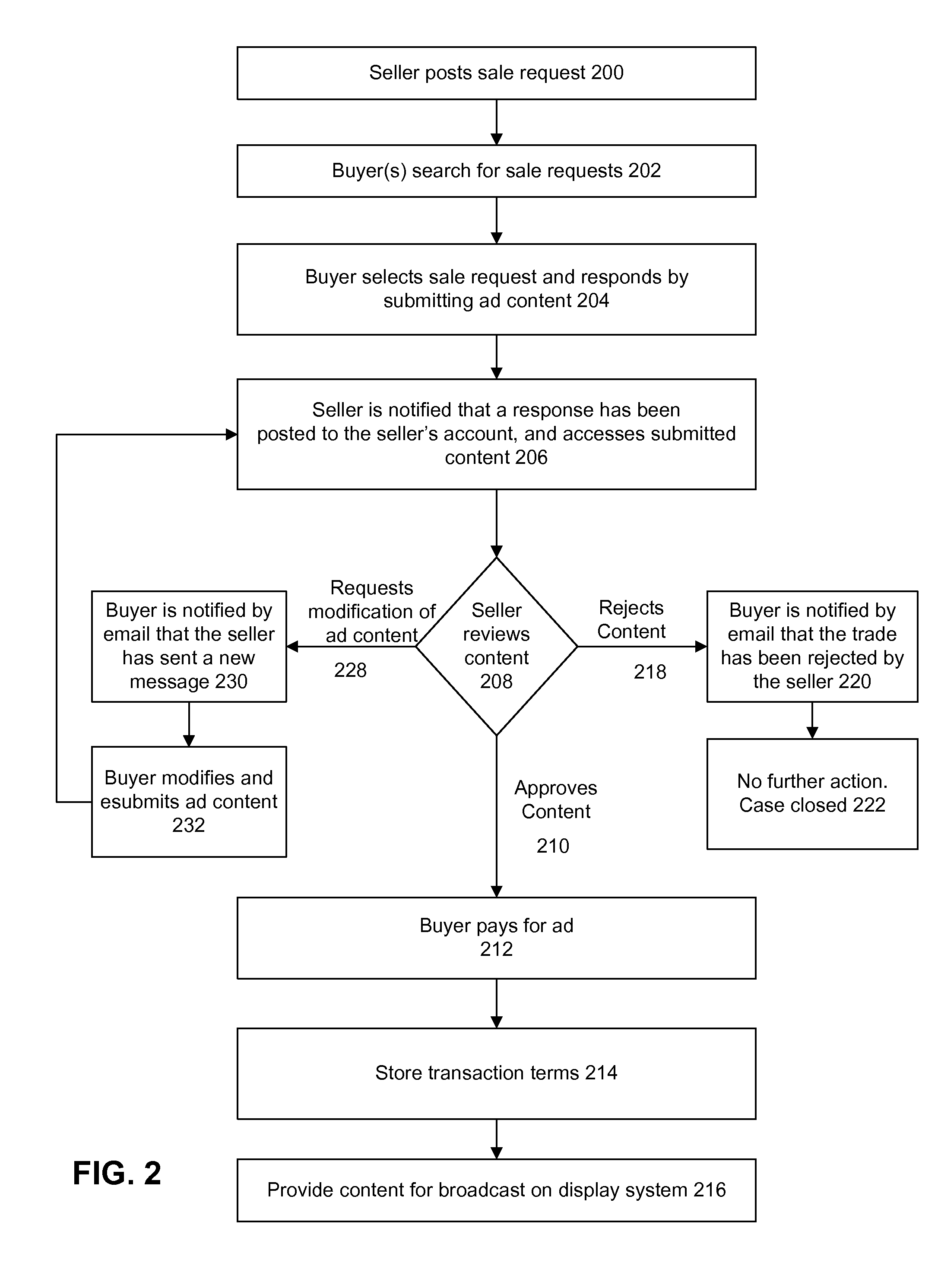

Online trading for the placement of advertising in media

An online trading system for conducting an advertiser initiated auction for the placement of an advertisement in a media, such as printed publications, billboards, radio, television, videos, network portals, web pages, and the like. An online session is conducted with the advertiser to form an auction ticket that specifies the price the advertiser is willing to pay for the advertisement. Also specified are dates the advertisement is to run, color preference, placement on a page or within the printed publication, and a list of media outlets from whom the advertiser wants to solicit bids. The media outlets are notified of the auction and given the auction ticket. Bids are submitted by specifying the amount of advertising space the media outlet is willing to allot for the specified price.

Owner:GOULD JEDD ADAM

System for facilitating online electronic transactions

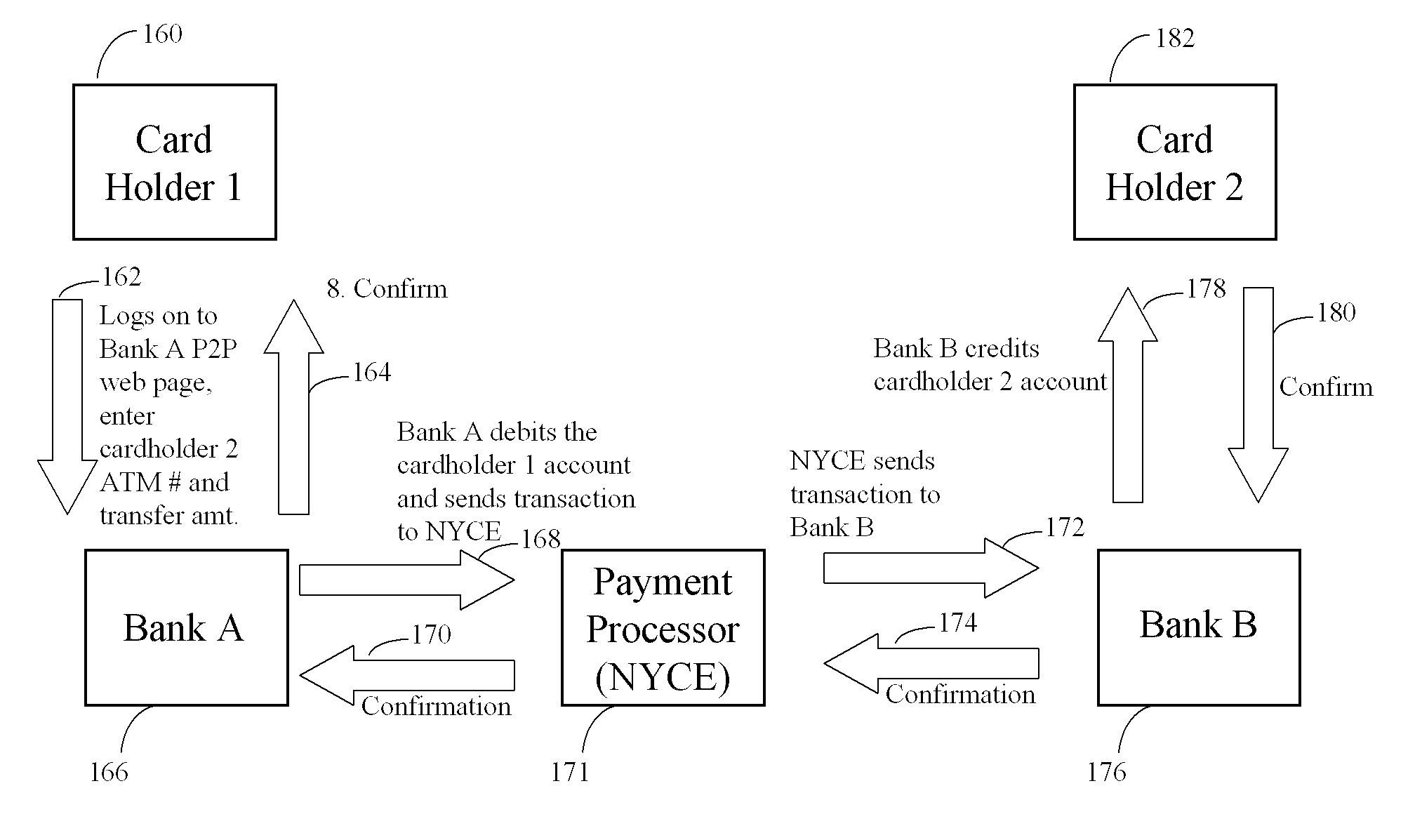

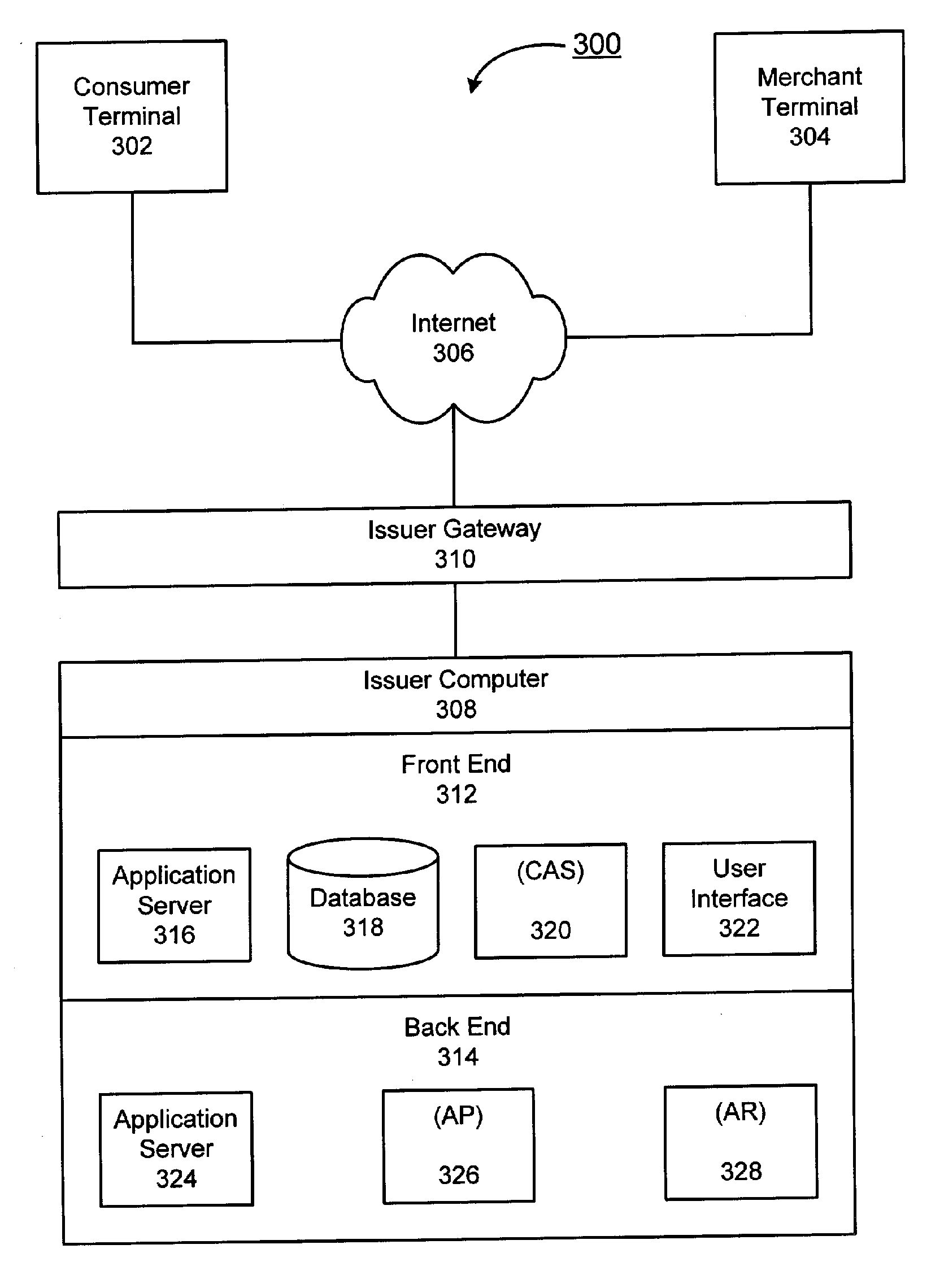

ActiveUS20060144925A1Increase contentReduced consumer-merchant-issuer interactionComplete banking machinesFinancePaymentWeb service

The invention provides systems and methods within existing business and technology infrastructures and processes for facilitating an electronic transaction including payment by an account issuer to a merchant for online purchases by a consumer. The invention uses a web services model including request and response messages to provide simplified authentication and authorization through entry of the consumer's PIN, without the release of the consumer's account or billing information to the merchant. The invention reduces authorization processing, and reduces the transaction fees for online transactions, increasing the viability of lower value transactions.

Owner:AMERIPRISE FINANCIAL

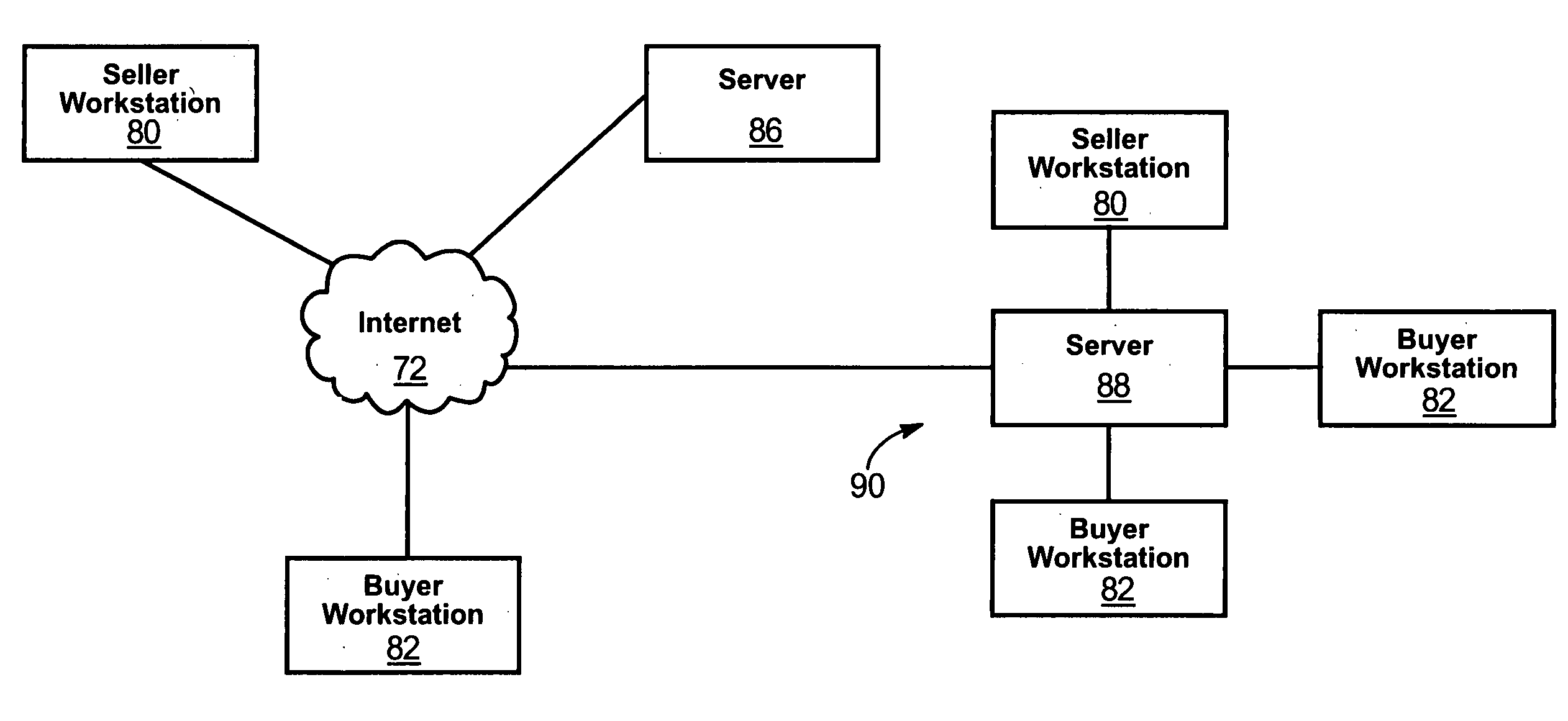

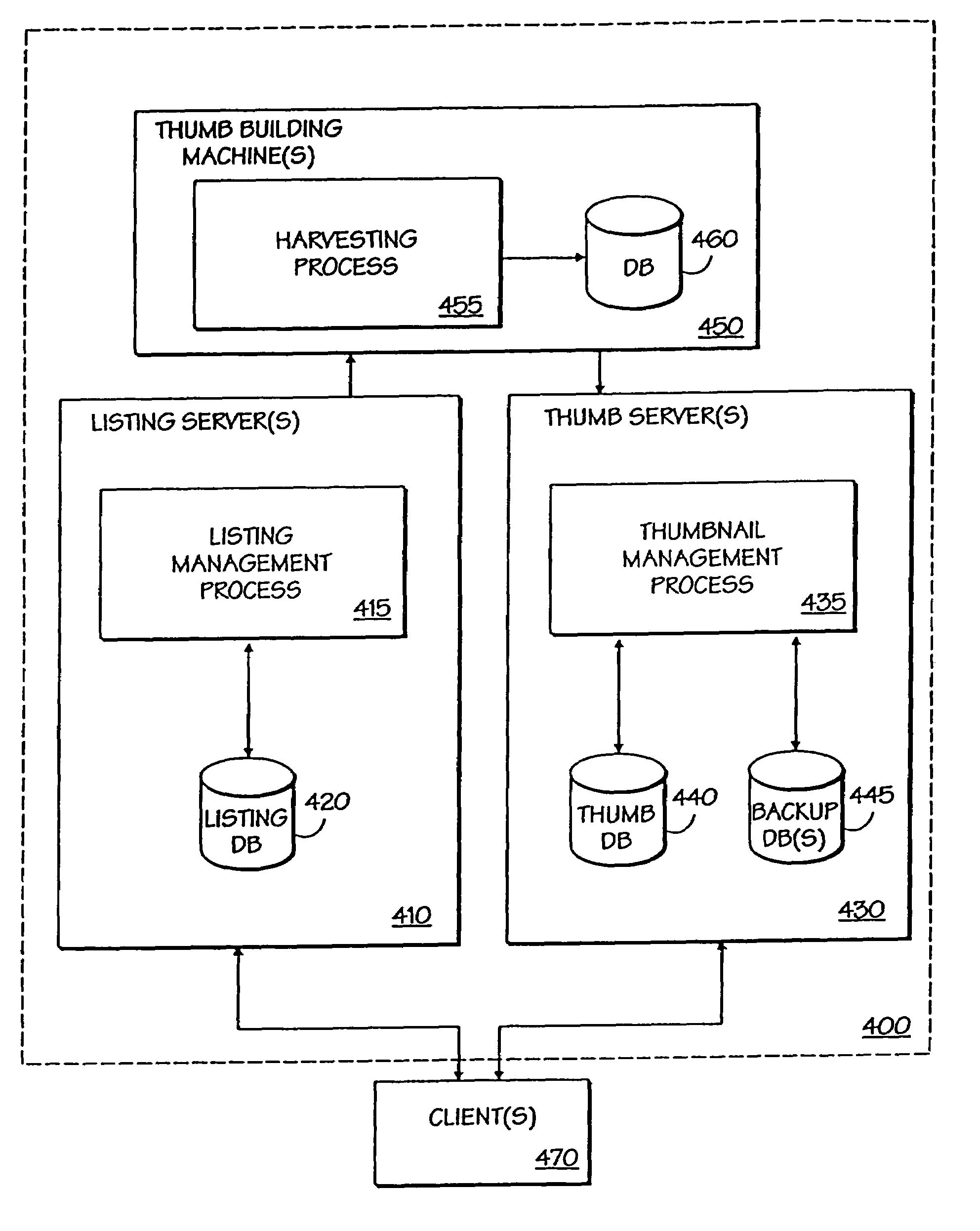

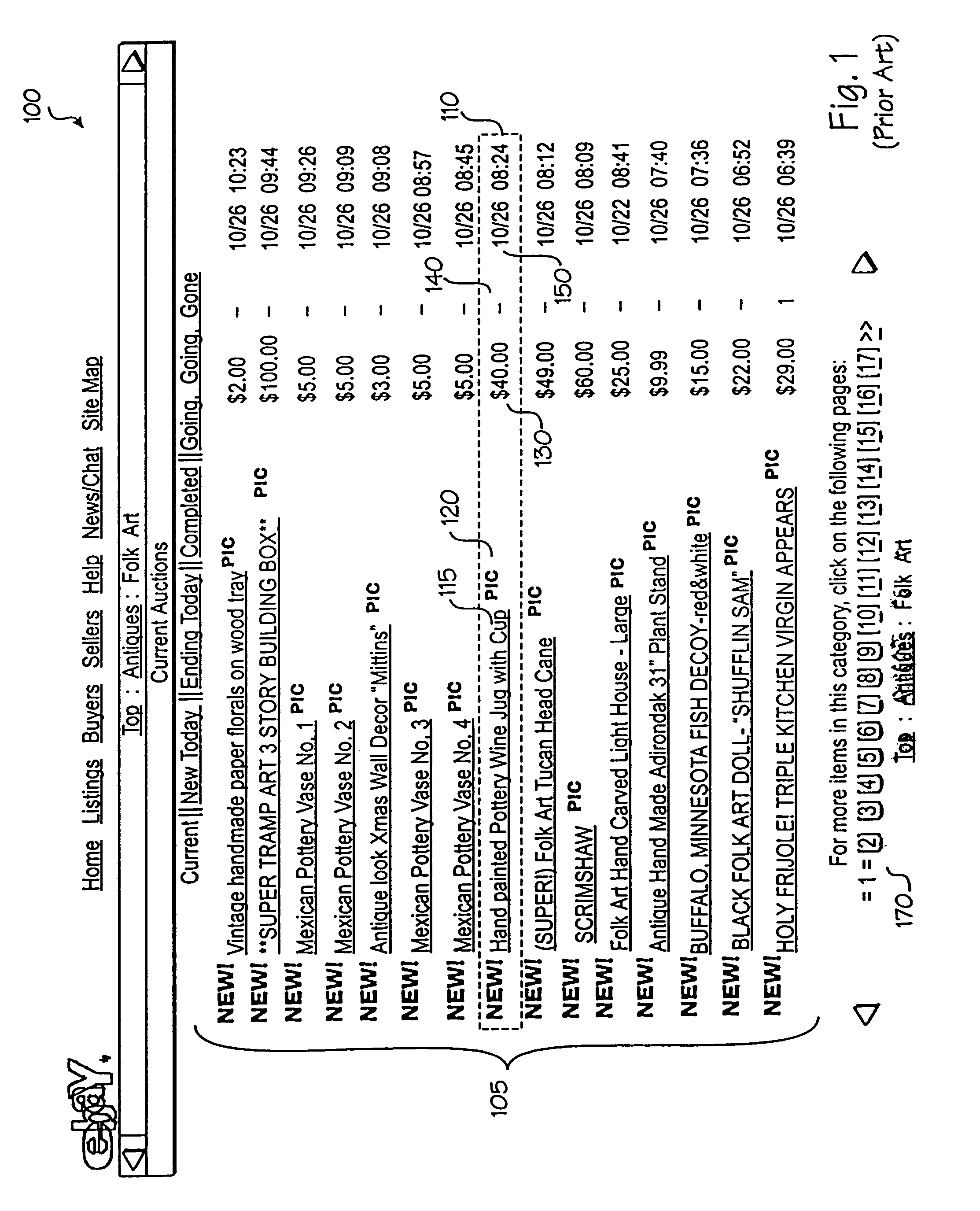

Information presentation and management in an online trading environment

InactiveUS7007076B1Quick previewFinanceStill image data indexingInformation presentationOnline trading

A method and apparatus for information presentation and management in an online trading environment are provided. According to one aspect of the present invention, person-to-person commerce over the Internet is facilitated by providing prospective buyers the ability to quickly preview items for sale. Images are harvested from a plurality of sites based upon user-supplied information. The user-supplied information includes descriptions of items for sale and locations from which images that are to be associated with the items can be retrieved. Thumbnail images are created corresponding to the harvested images and are aggregated onto a web page for presentation at a remote site. According to another aspect of the present invention, a user may submit a query to preview items for sale. After receiving the query, thumbnail images corresponding to items that satisfy the user query are displayed, each of the thumbnail images previously having been created based upon a user-specified image.

Owner:EBAY INC

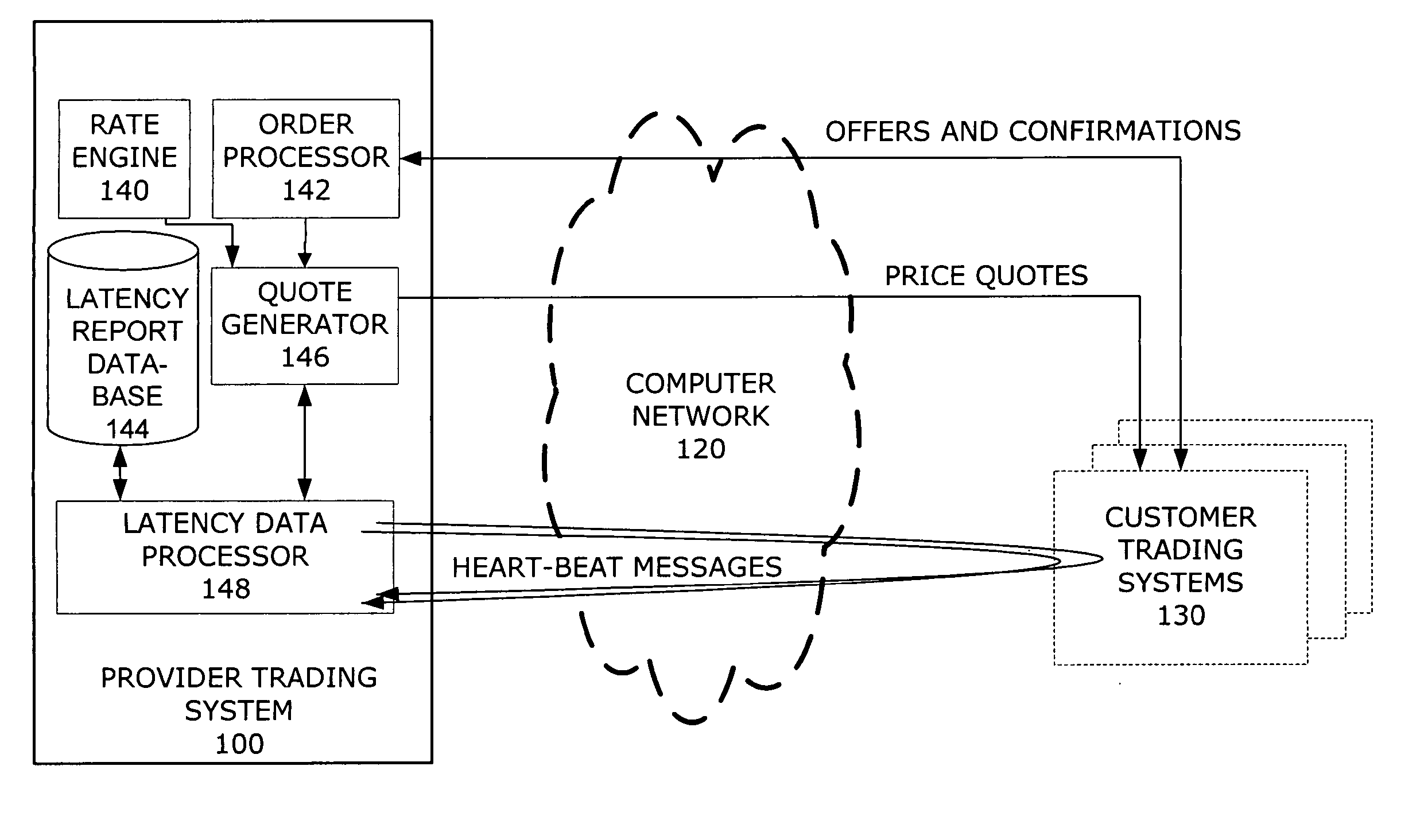

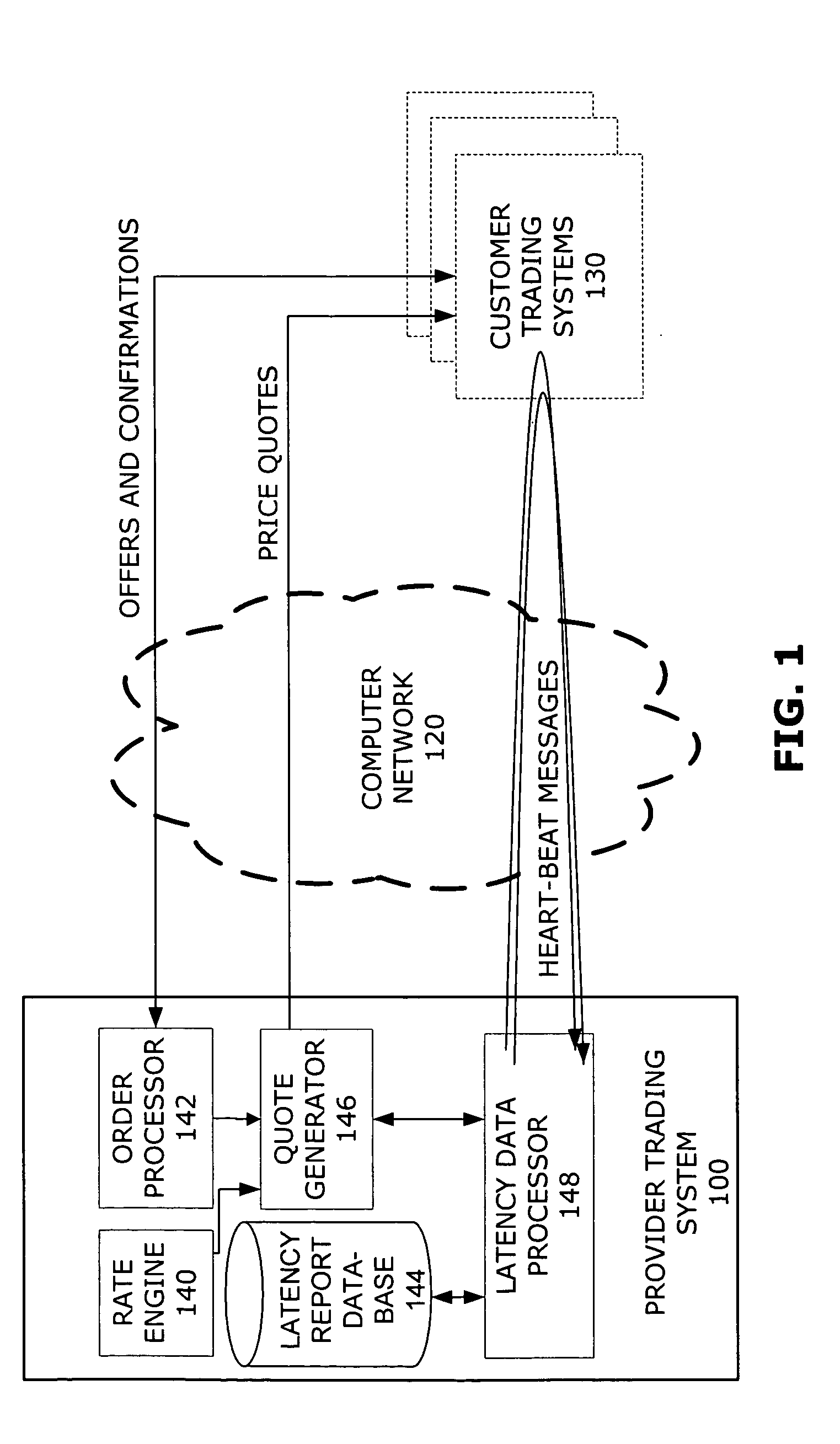

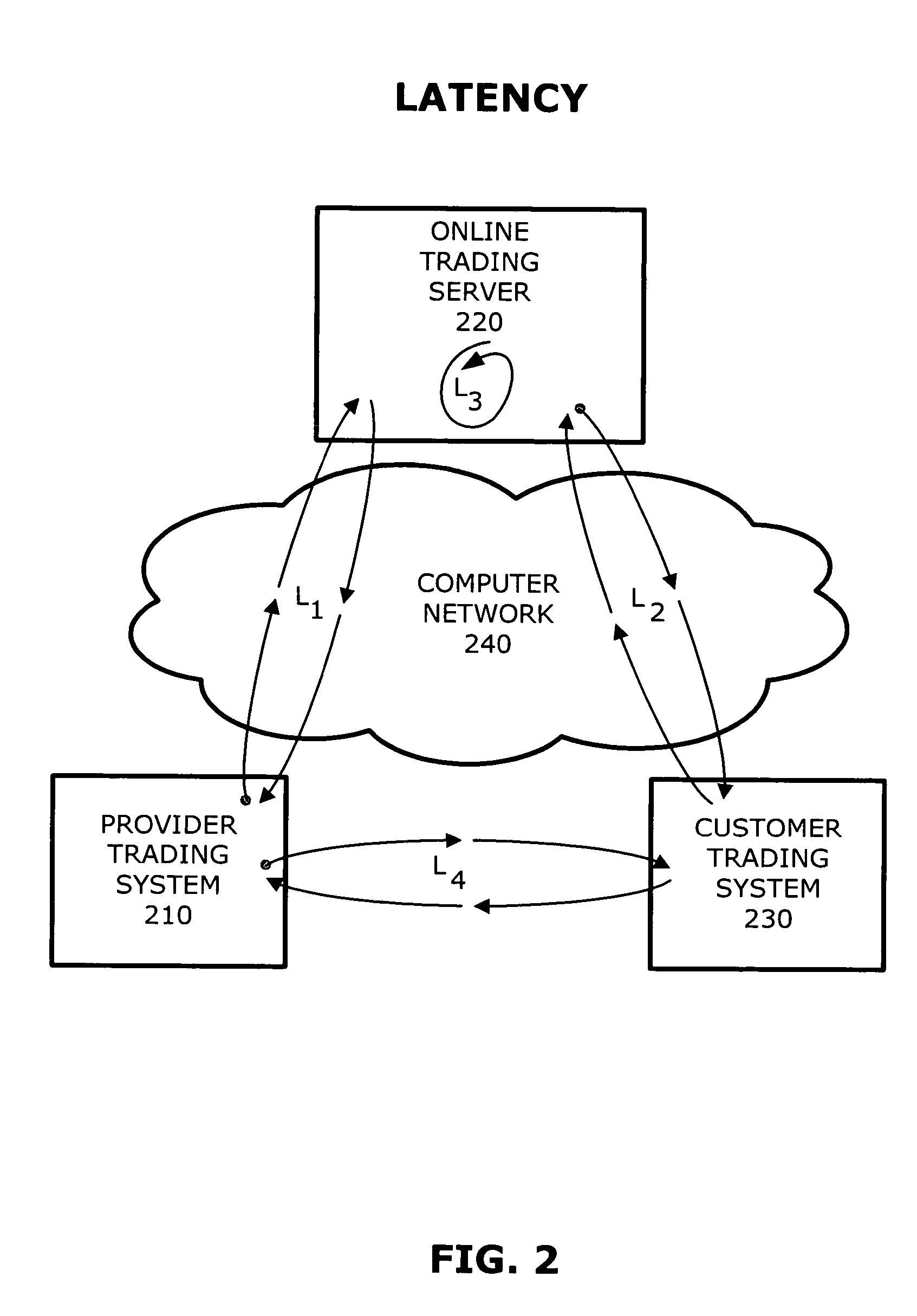

Latency-aware asset trading system

InactiveUS20050137961A1Significant delayHigh frequencyFinanceSpecial data processing applicationsPrice quoteOnline trading

An online trading system for providers, customers and online trading servers, as well as methods of conducting online trading transactions, that incorporate processing components and steps that measure, monitor, report and utilize up-to-date network latency data to process offers to deal so that an unnecessarily large number of deals will not be refused. The systems and methods may also be used to make adjustments to the frequency and content of price quotes, based on current latency data, to improve customers' opportunity to submit offers that will arrive timely. The invention provides banks (and other liquidity providers), as well as online trading server operators, with sufficient information concerning network latencies so that price quotes issued by the banks can be “tuned” and customized so that they will not expire before the bank's customers have a reasonable opportunity to review the price quotes and submit offers to deal.

Owner:FX ALLIANCE

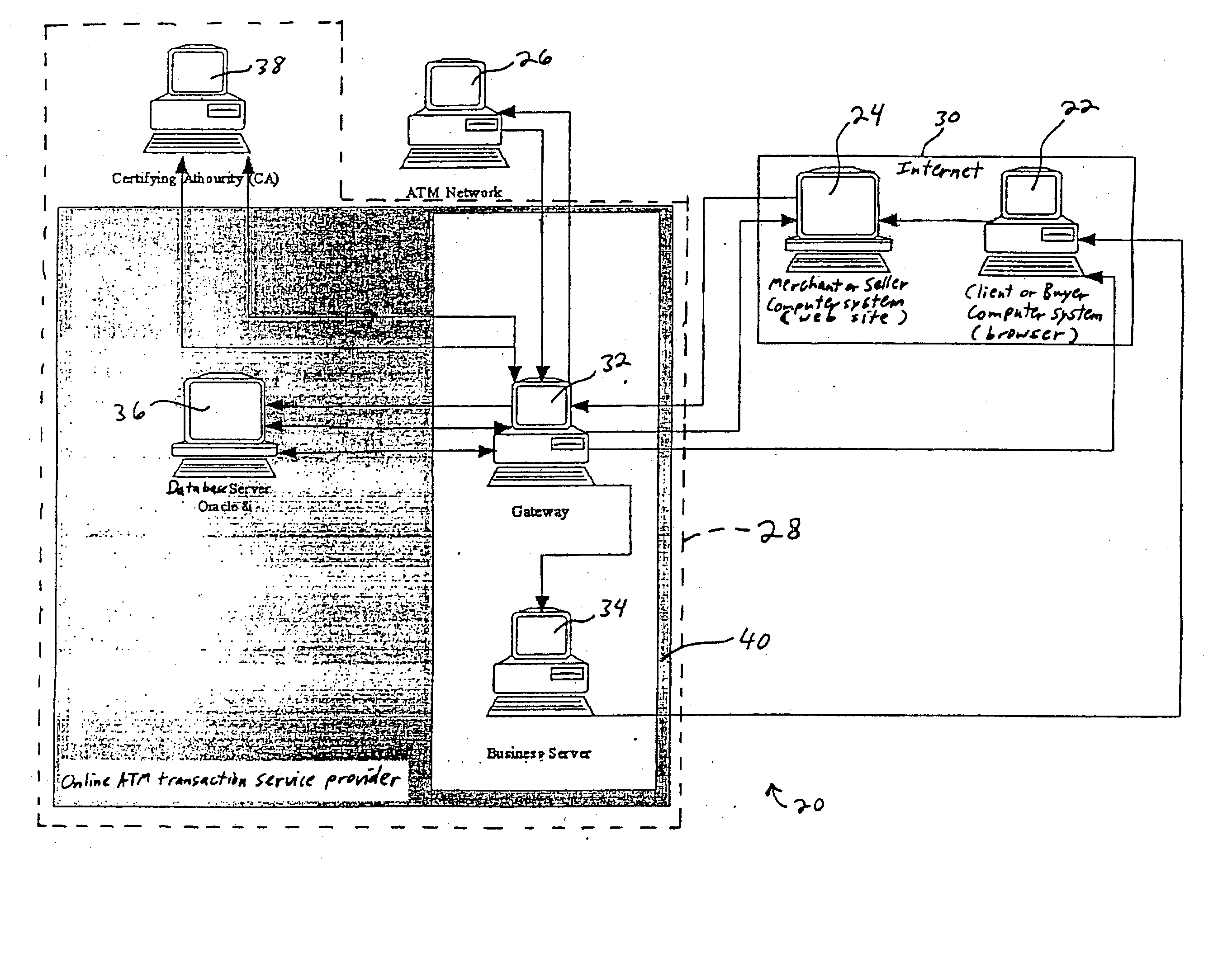

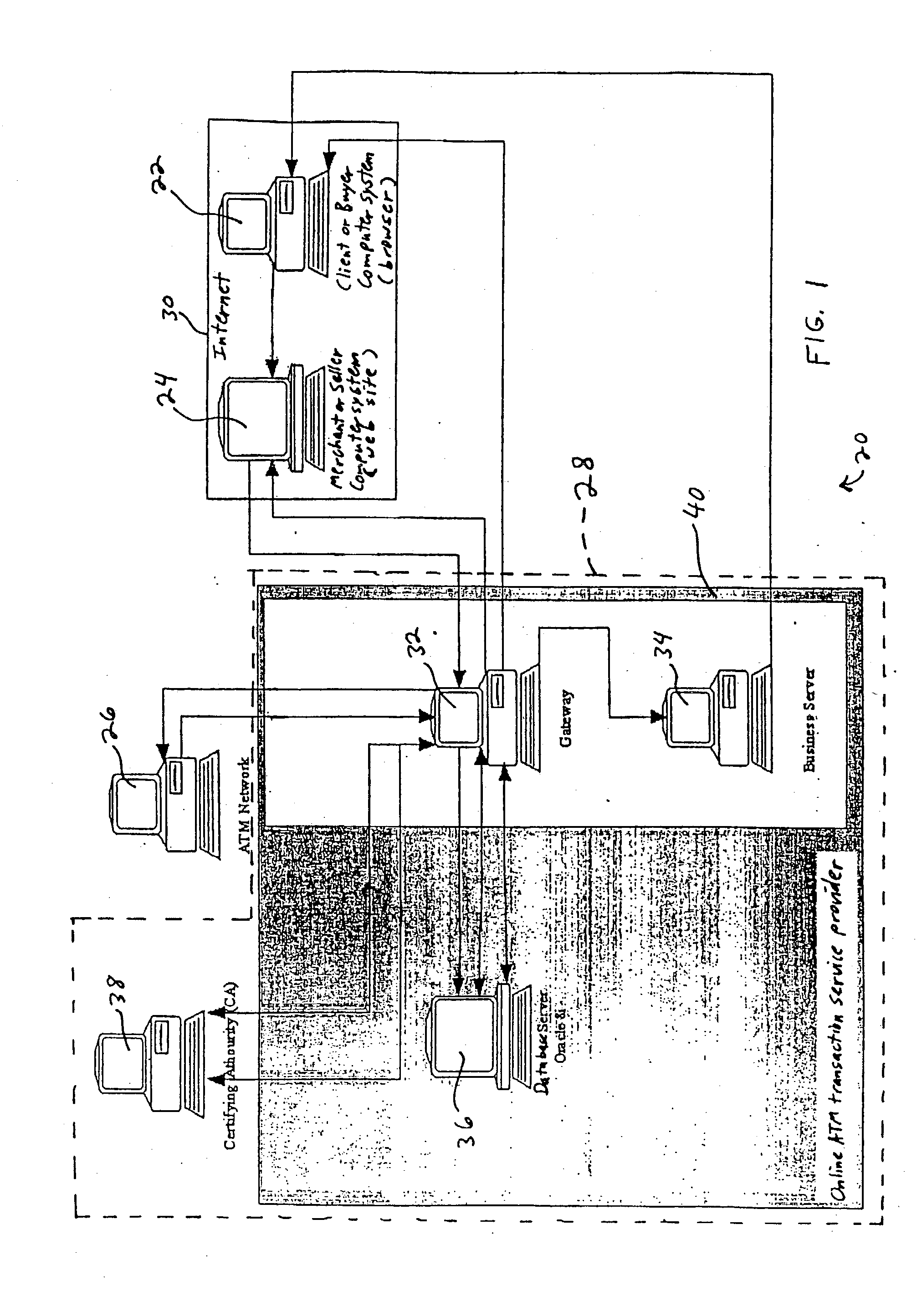

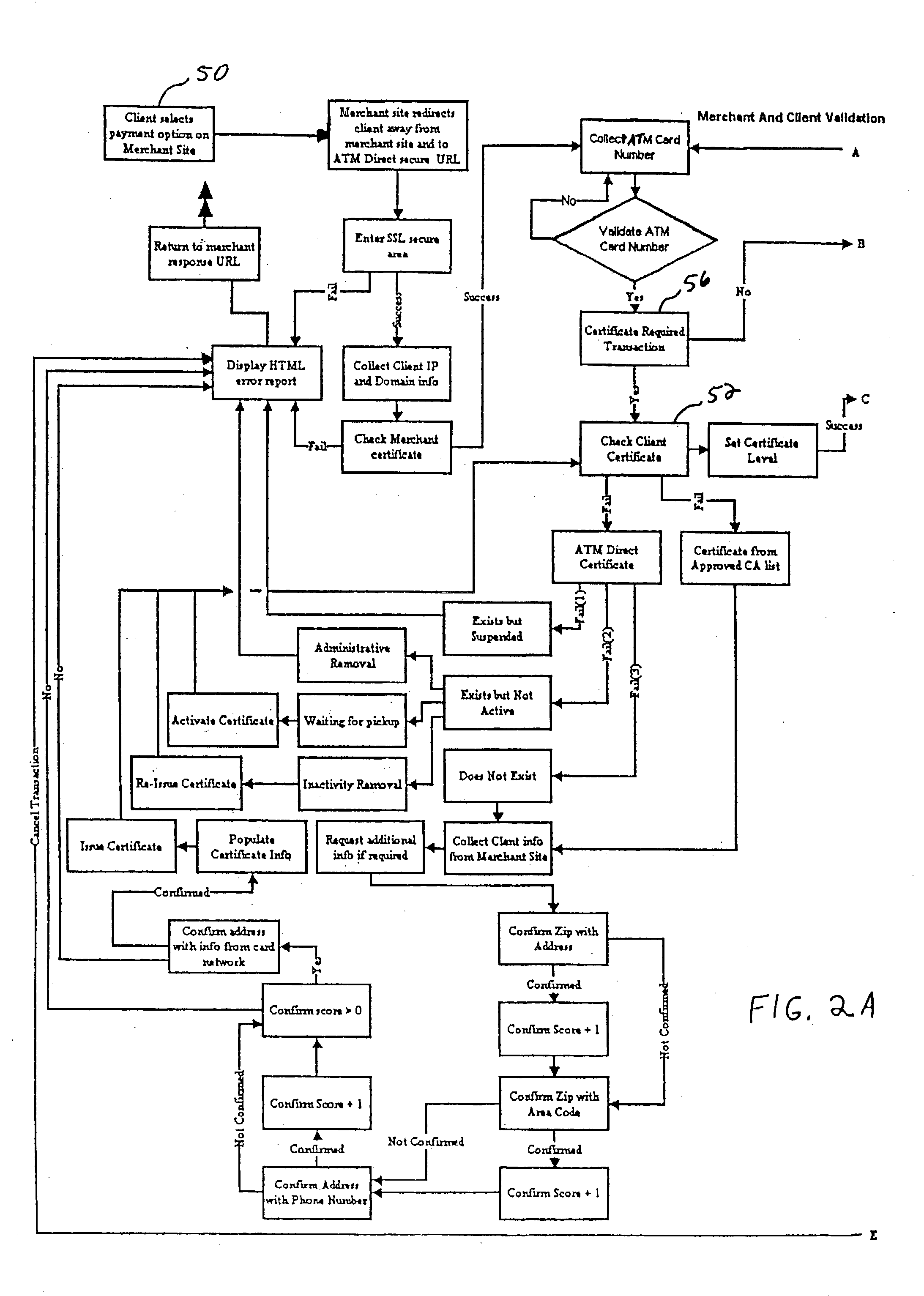

Online ATM transaction with digital certificate

InactiveUS20050085931A1Convenient transactionComplete banking machinesComputer controlPaymentWeb site

A system and method are provided for performing a secure ATM debit transaction for a buyer making a payment to a seller over the Internet. The system comprises an ATM debit network, a seller web site, a transaction computer system, and a software program. The ATM debit network links together a plurality of banks, financial institutions, and ATM machines. The seller web site is accessible to the buyer via the Internet. The transaction computer system is adapted to be communicably coupled to the seller web site and the ATM debit network as needed to perform the secure ATM debit transaction. The software program on the transaction computer system is adapted to authorize and facilitate the secure ATM transaction between the seller and the buyer using at least one digital certificate. When the secure ATM transaction is authorized by at least authenticating the at least one digital certificate, the software program submits a debit request to the ATM debit network corresponding to the secure ATM debit transaction.

Owner:ATMDIRECT +1

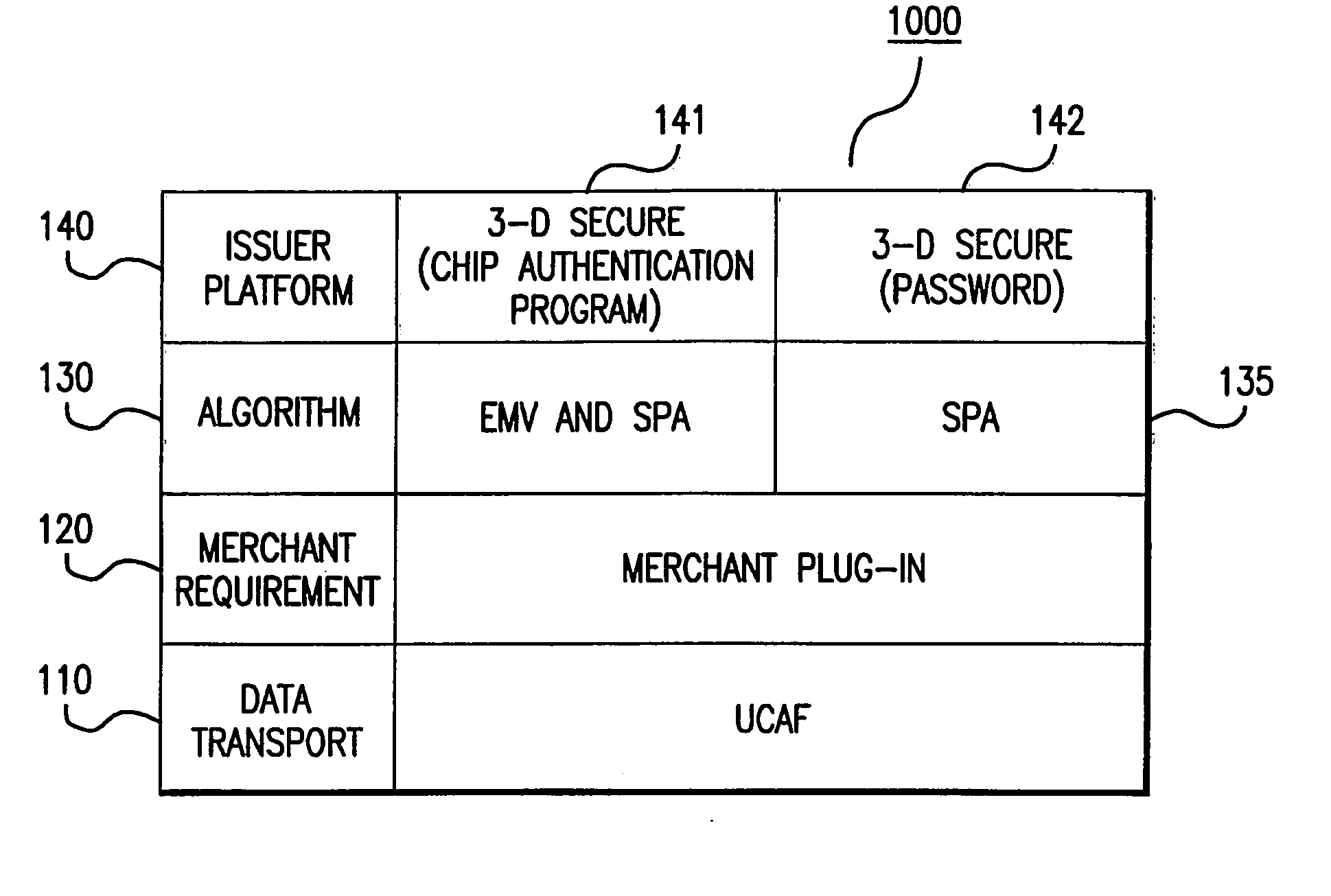

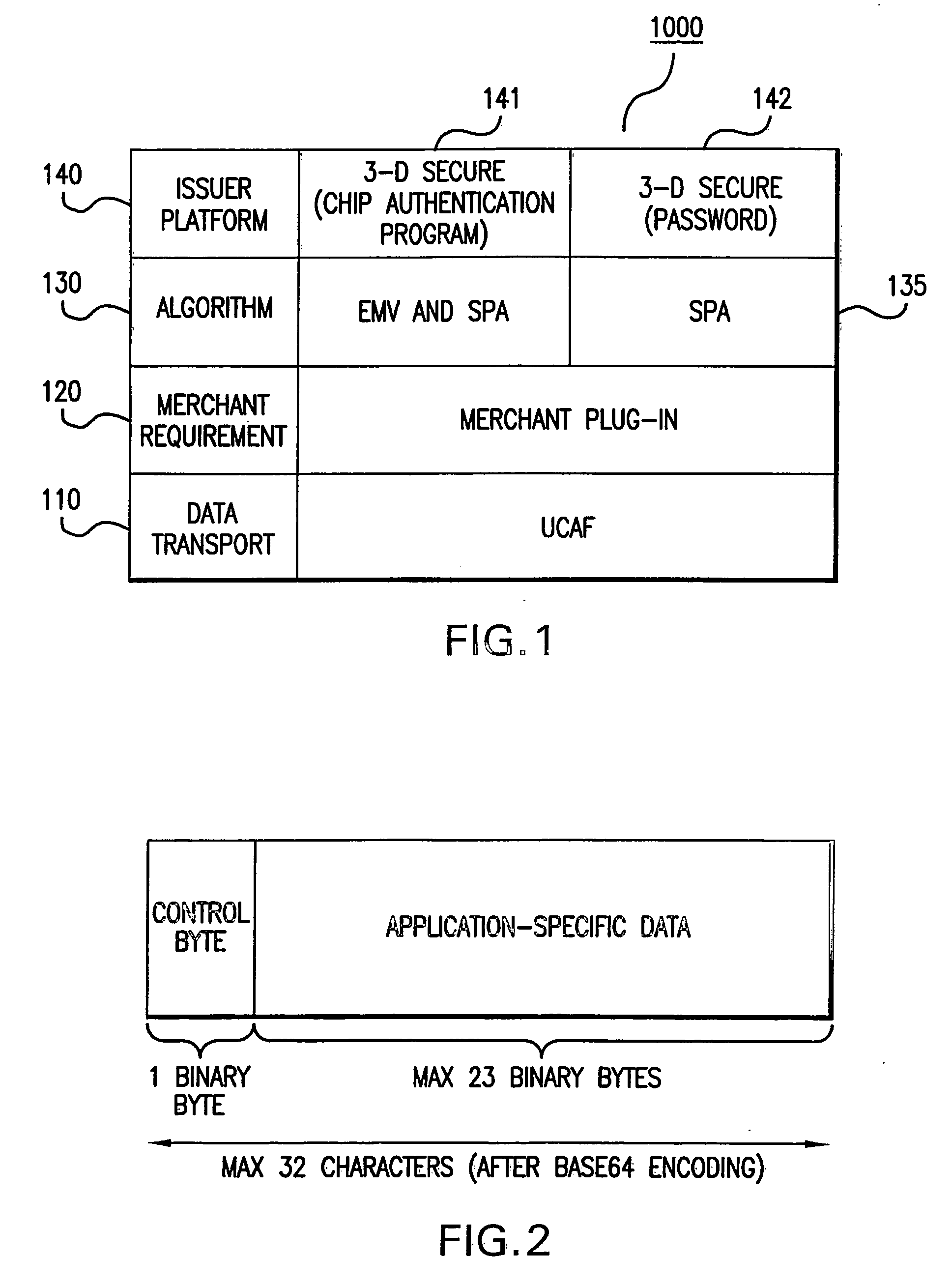

Systems and methods for conducting secure payment transactions using a formatted data structure

ActiveUS20070143227A1Strengthen the systemImprove methodDigital data authenticationBilling/invoicingPayment transactionE-commerce

A formatted data structure is provided for conveying the results of ecommerce authentication programs that are used to authenticate a cardholder's on-line transactions. The data structure, which has at most a 20-byte length, is designed to be compatible with 3-D Secure message protocols used in e-commerce. The data structure includes designated fields that include a hash of the merchant's name, identify an authentication service provider, identify the authentication method used, and include a merchant authentication code which ties cardholder information to the transaction. Secure payment algorithms are provided for use by the e-commerce authentication programs to generate authentication results in the desired format. In one secure payment algorithm, a secret key is used to encrypt a concatenation of a cardholder account number with information from designated fields of the data structure. In another secure payment algorithm, a pair of secret keys is used to encrypt a concatenation of the cardholder's account number, card expiration date and service code. In both cases, portions of the encryption results are used to define the merchant authentication code.

Owner:MASTERCARD INT INC

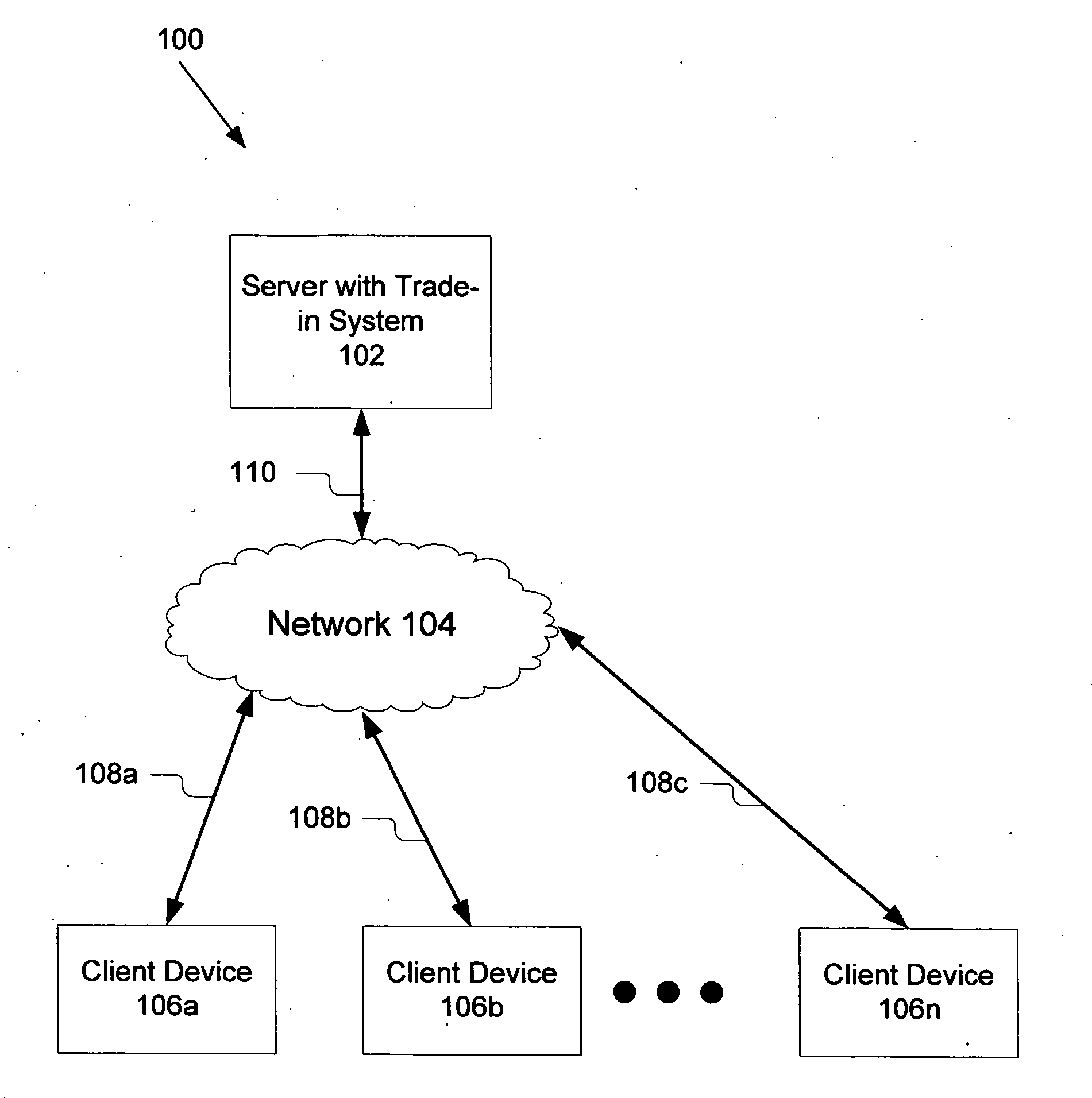

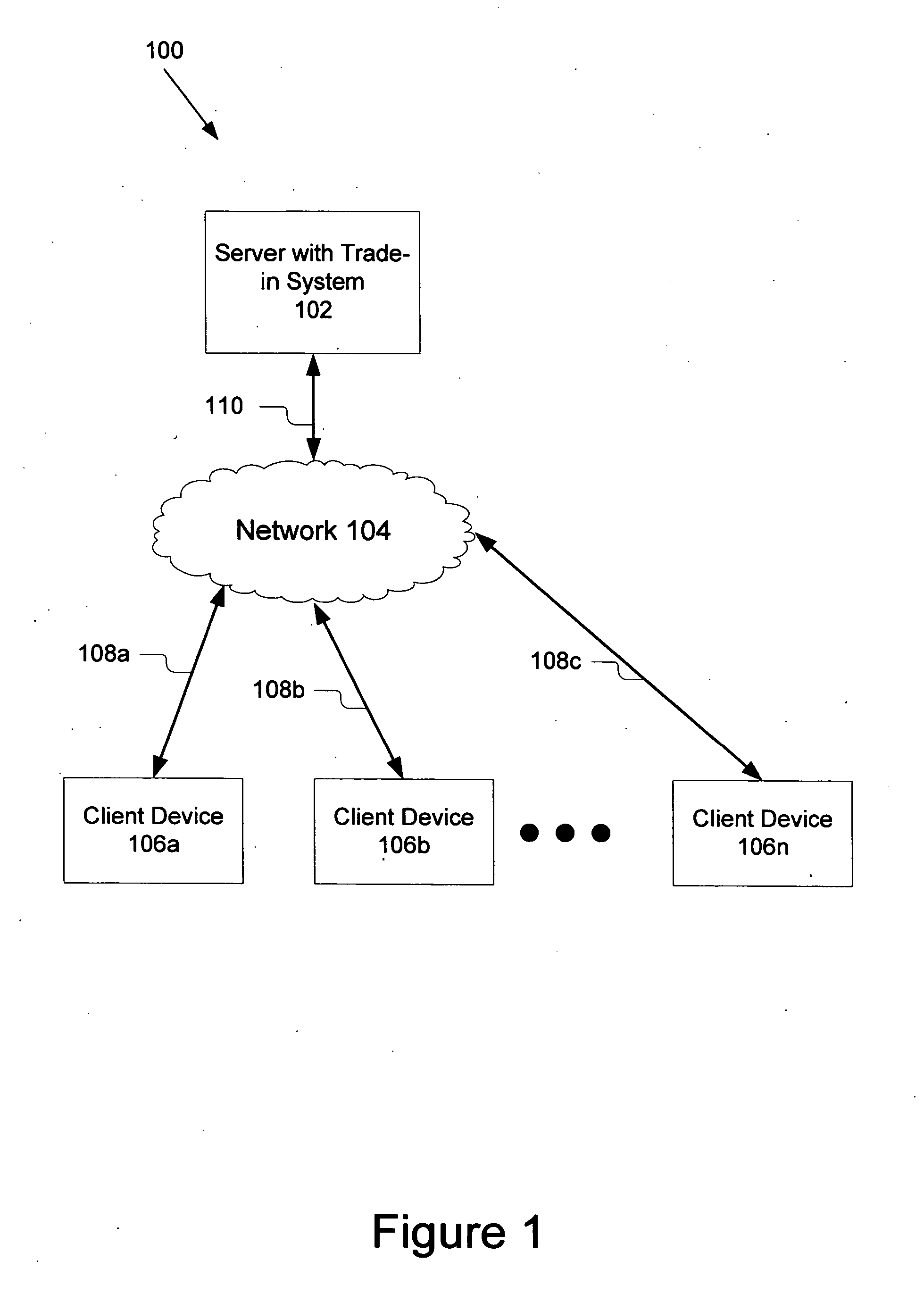

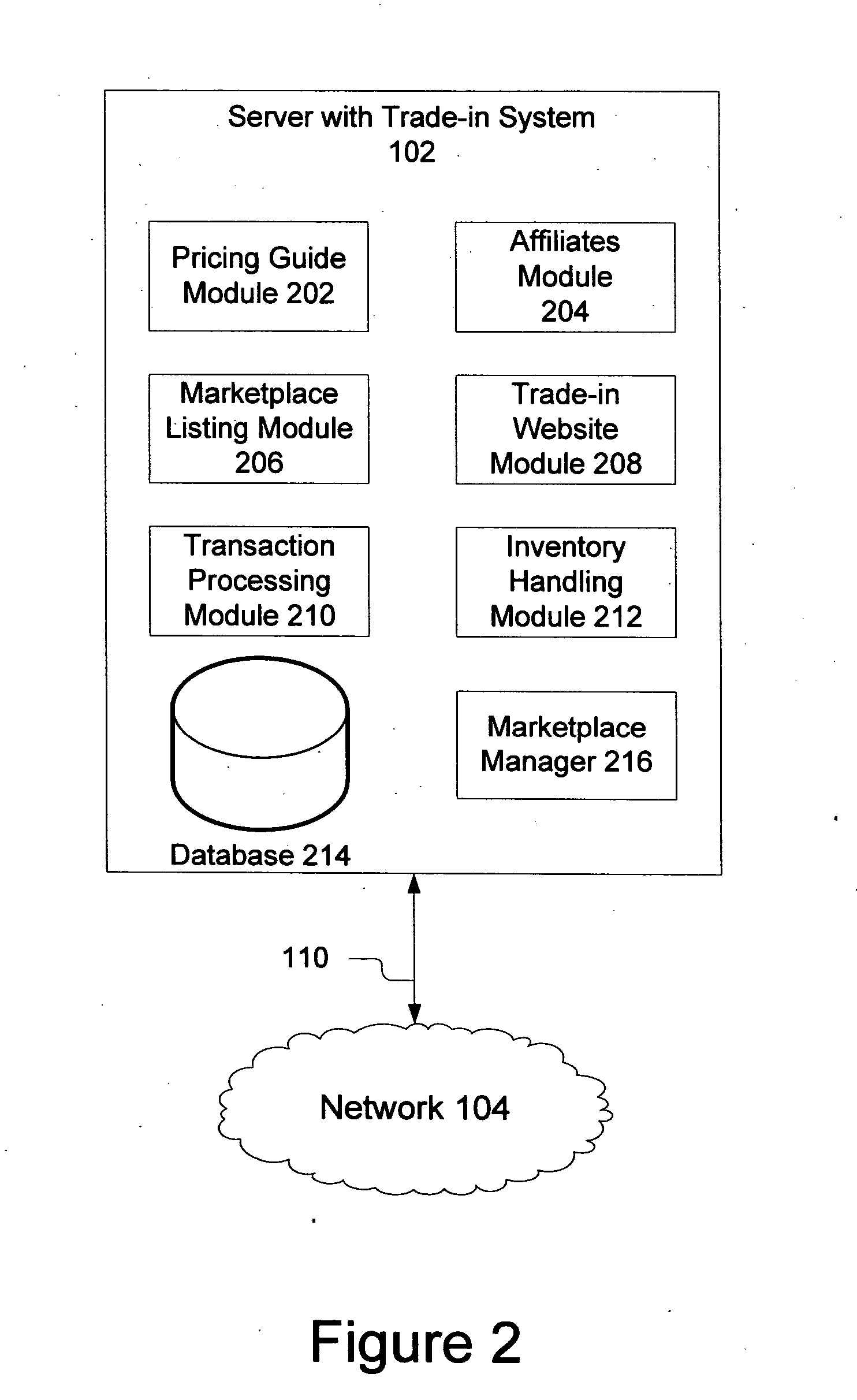

Systems and methods for online trade-in of goods

An online trade-in system comprises: a pricing guide module, an affiliates module, a marketplace listing module, a trade-in website module, a transaction processing module, an inventory handling module, a database and a marketplace manager. The marketplace manager creates an online trade-in system that accesses the other modules to complete a trade-in transaction. The pricing guide module is used to define the items that are acceptable by the merchant for trade-in as well as a price for each item. The marketplace manager uses information from the pricing guide module and provides it to the transaction processing module along with user input to begin and create a trade-in transaction. The marketplace manager uses also controls the inventory handling module to generate a reverse logistic label that can be used by the user to send the trade-in goods back to the merchant, and track the trade-in goods as well as initiate the process to list the item on an online marketplace. The present invention also includes a number of novel methods including: a method for performing an online trade-in, a method for creating a pricing guide, a method for handling inventory, a method for item record creation, a method for dynamic pricing of trade-in goods, and a method for performing trade-ins for affiliates.

Owner:INFOPIA INC

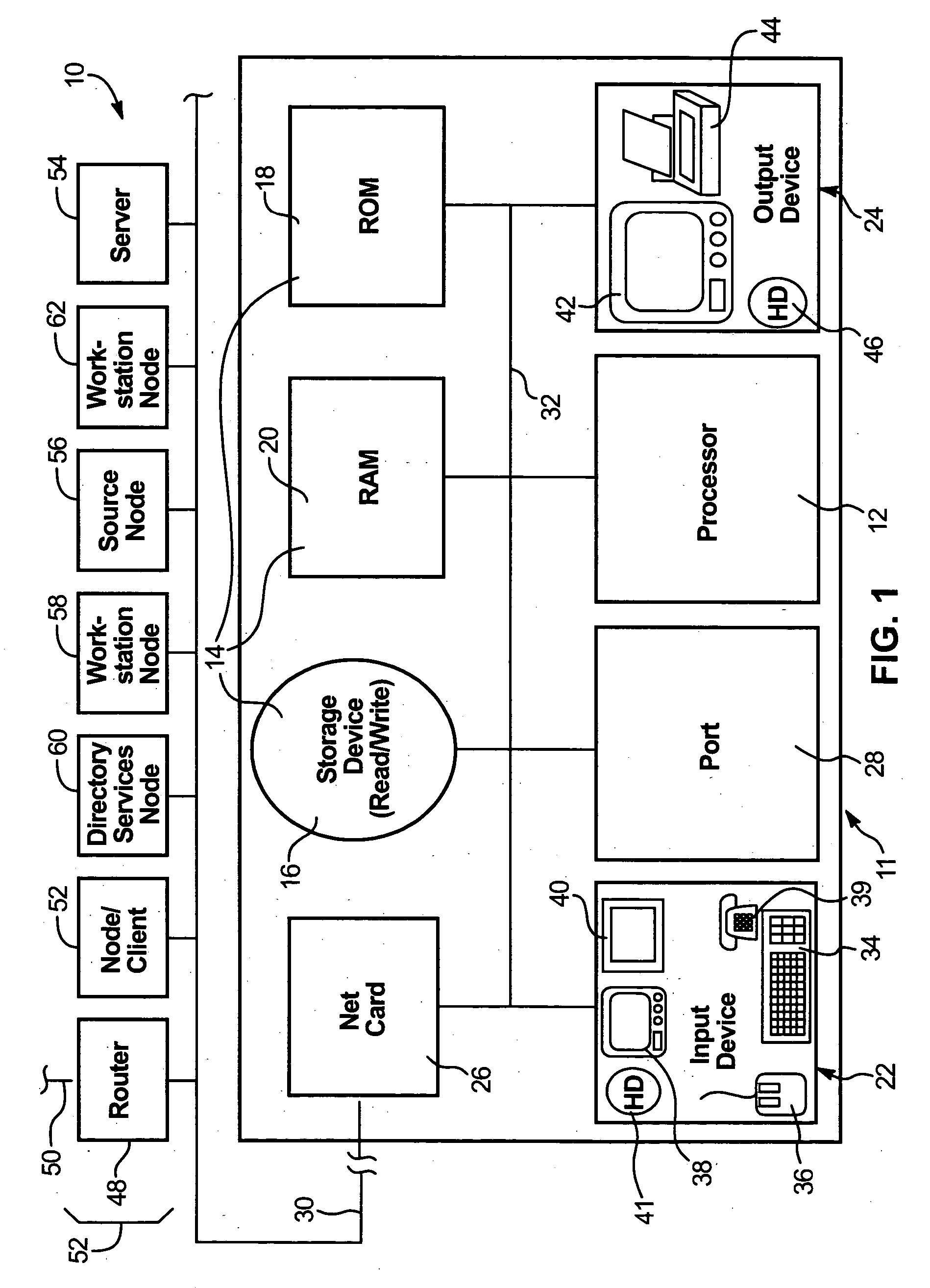

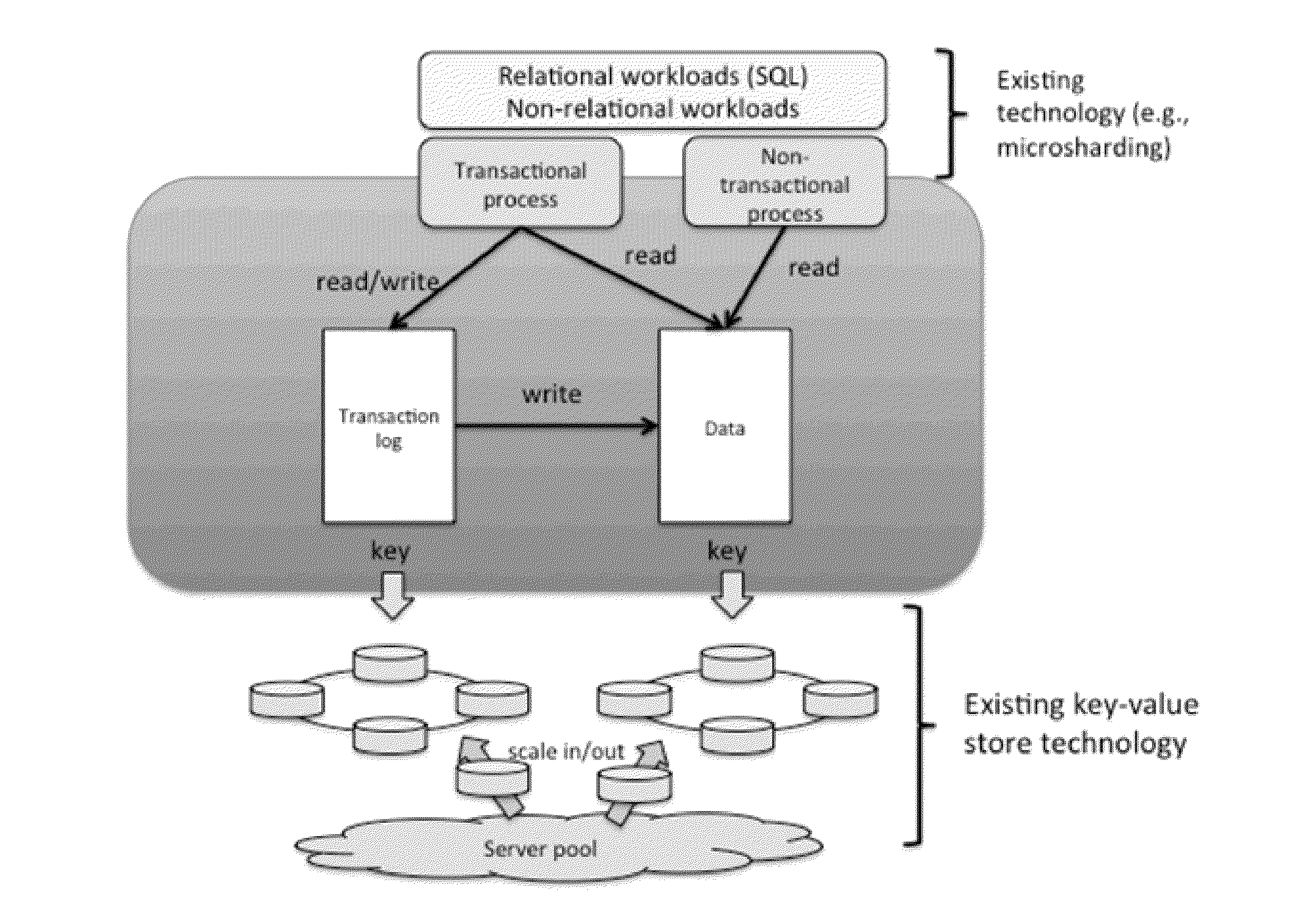

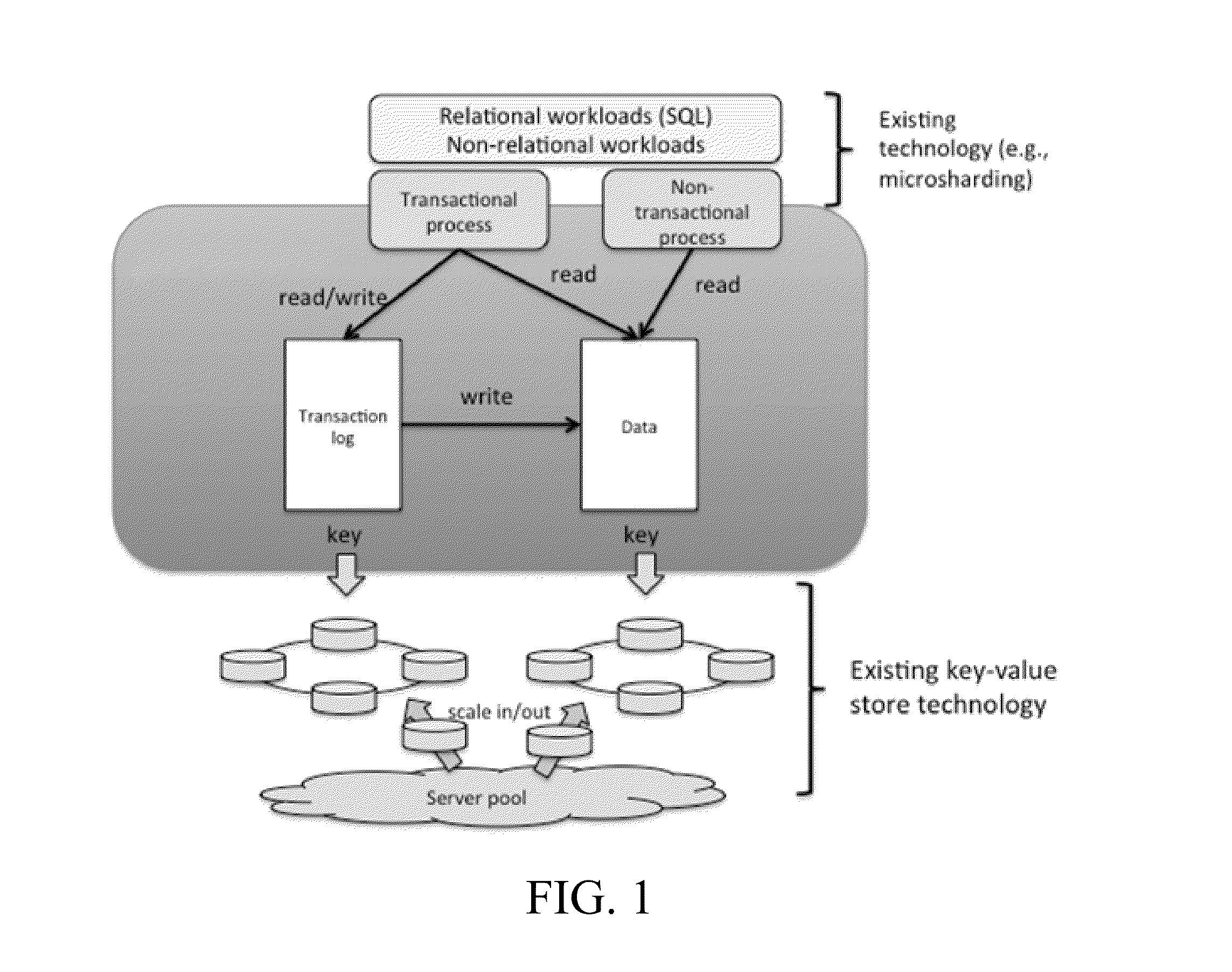

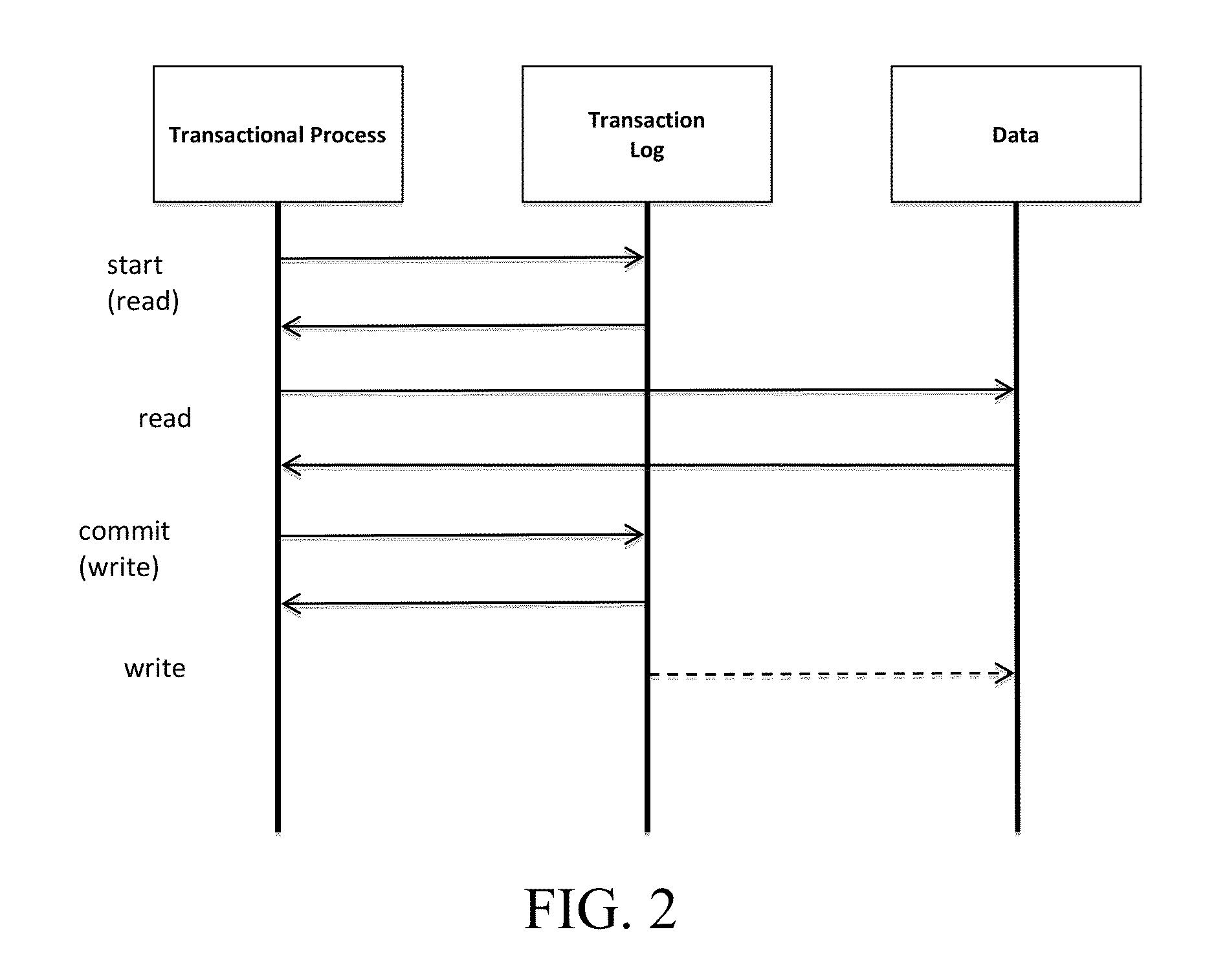

Online Transaction Processing

InactiveUS20130110767A1ElasticityDigital data processing detailsDatabase distribution/replicationTransaction logOnline trading

A method implemented in an online transaction processing system is disclosed. The method includes, upon a read request from a transaction process, reading a transaction log, reading data stored in a storage without accessing the transaction log, and constituting a current snapshot using the data in the storage and the transaction log. The method also includes, upon a write request from the transaction process, committing transaction by accessing the transaction log. The method also includes propagating update in the commit to the data in the storage asynchronously. The transaction commit is made successful upon applying the commit to the transaction log. Other methods and systems also are disclosed.

Owner:NEC LAB AMERICA

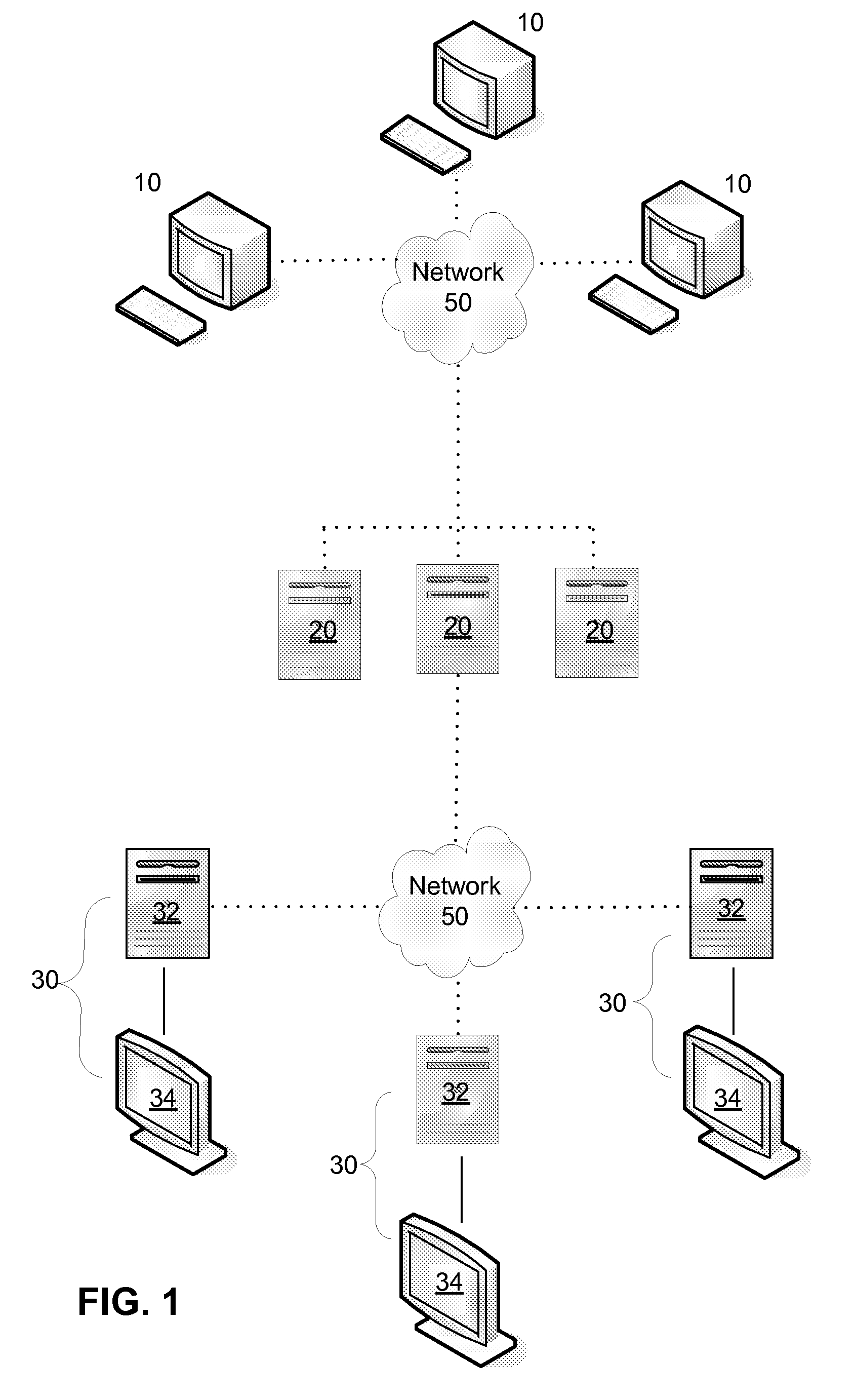

Digital Signage Transaction and Delivery Methods

Methods for providing digital signage advertisements for display in retail locations are described. In an embodiment, the method comprises facilitating an on-line transaction for digital signage advertisement space in a retail location, receiving a digital signage advertisement responsive to the on-line transaction, and providing over an electronic network the digital signage advertisement for display in the retail location. Pricing data on past digital signage advertisement transactions may be provided for determining a price to be charged for the digital signage advertisement space. The advertisement may be provided over a network to a satellite, simulcast, or narrowcast server to be broadcast to a display system in the retail location.

Owner:MYADTV

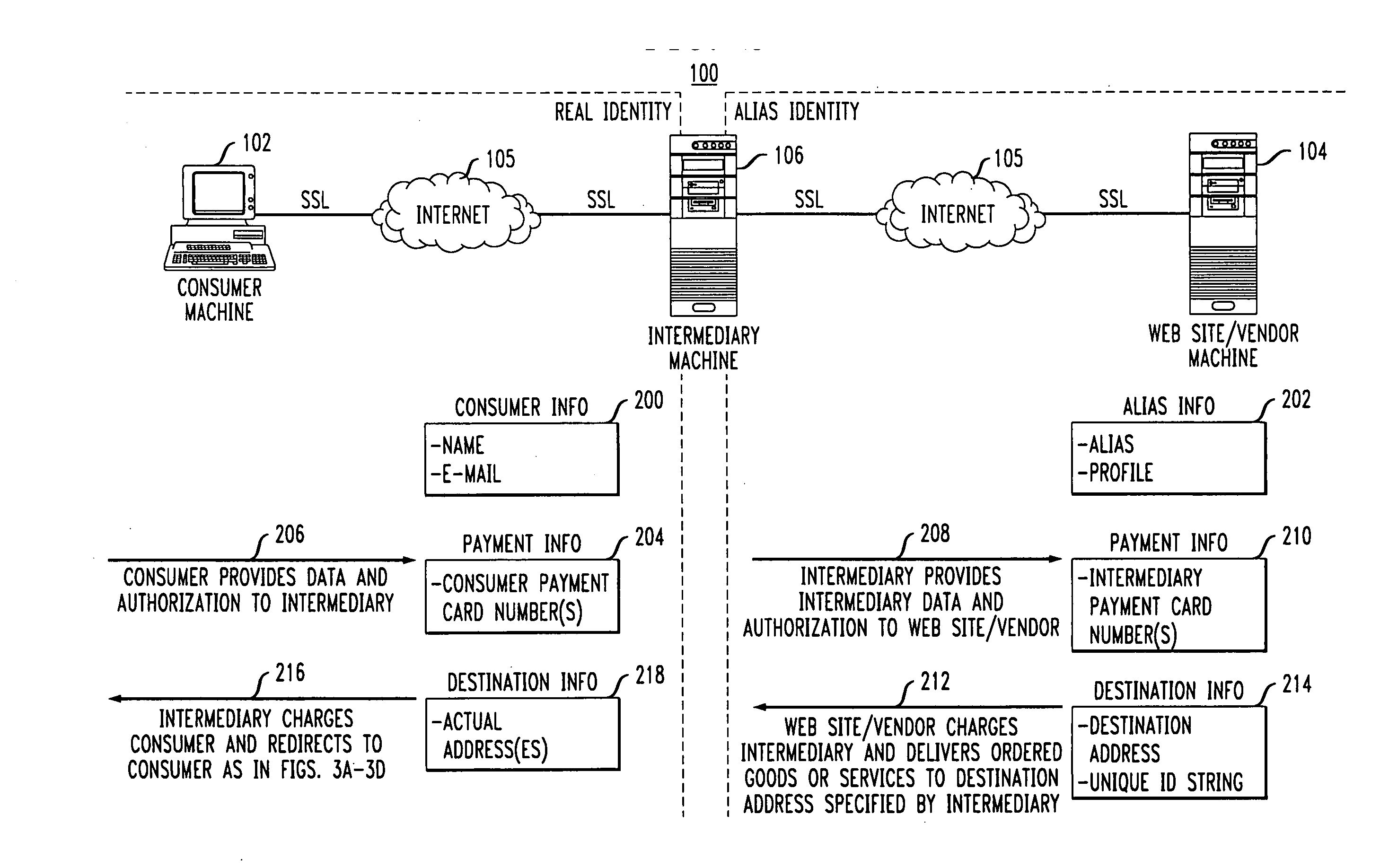

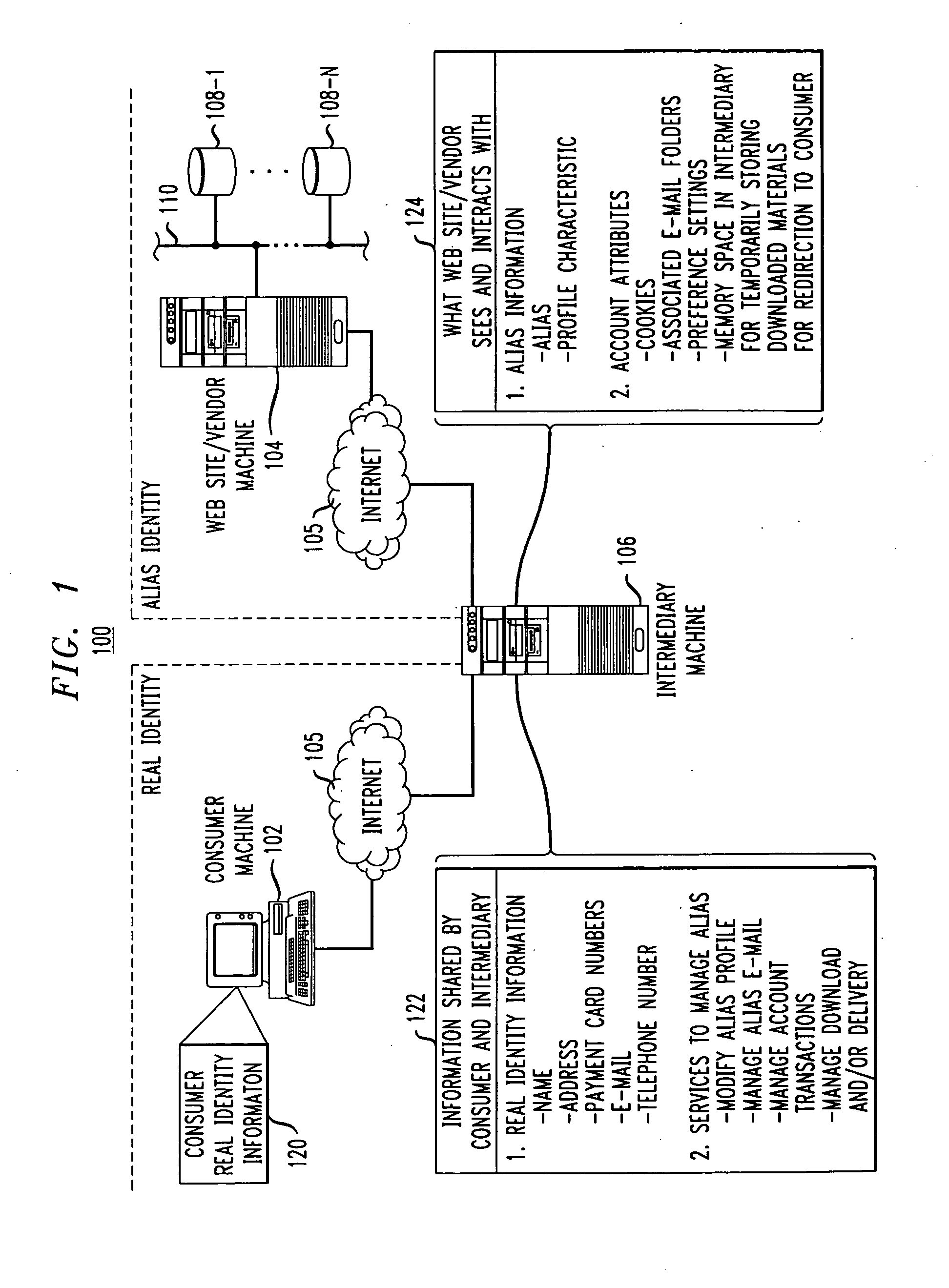

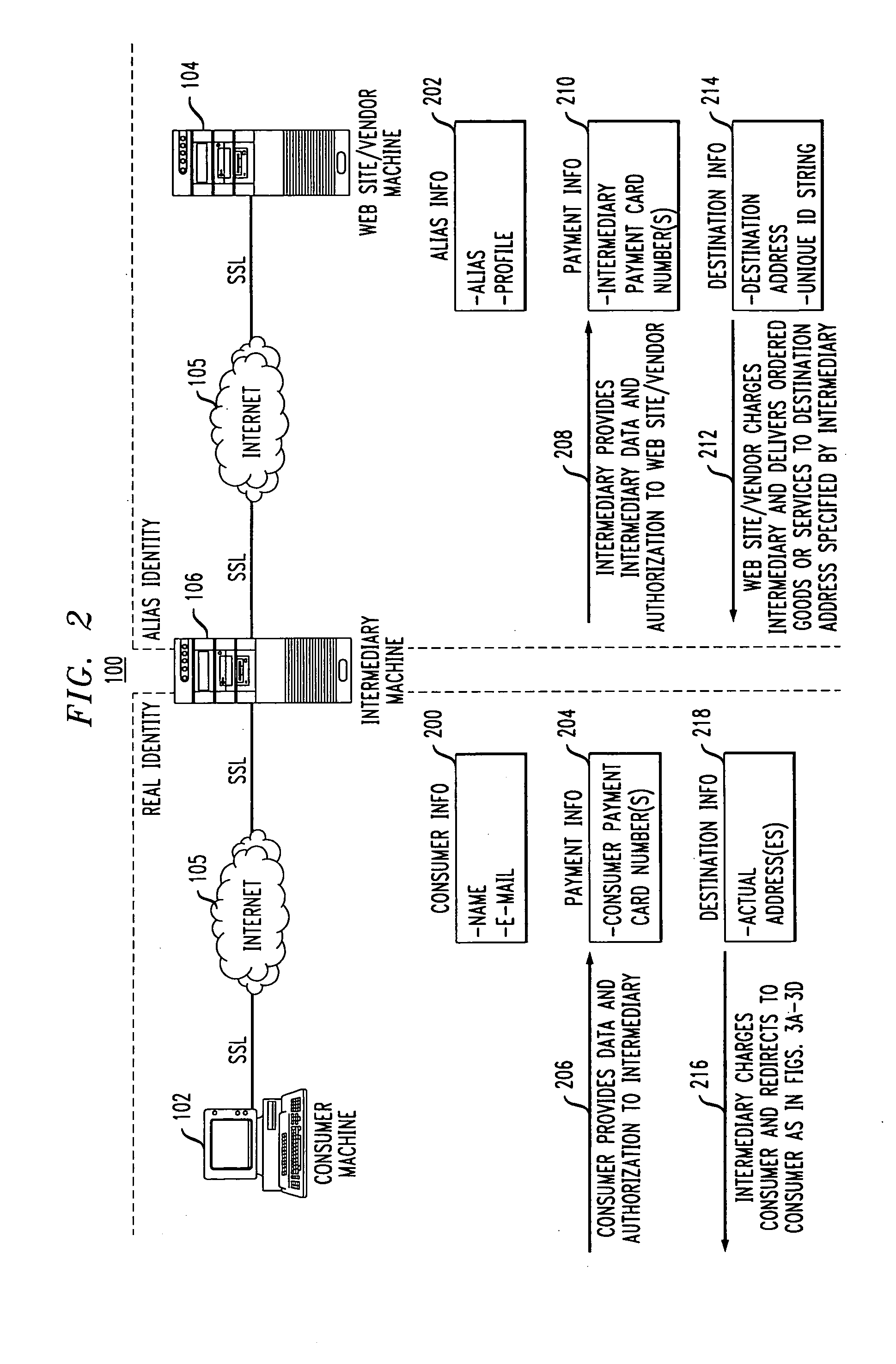

Methods and apparatus for providing user anonymity in online transactions

InactiveUS20060274896A1Avoid the needEliminate the problemDigital data processing detailsMultiple digital computer combinationsPaymentWeb site

End-to-end user anonymity is provided in electronic commerce or other types of online transactions through the use of an intermediary. An intermediary machine, which may be implemented in the form of a set of servers or other type of computer system, receives communications from a consumer or other user, and generates and maintains an alias for that user. Connections between the user machine and any online vendor or other web site are implemented through the intermediary using the alias. When the user desires to make a purchase from a given online vendor, the intermediary may present the user with a number of options. For example, the user may be permitted to select a particular payment card number and real destination address as previously provided to the intermediary. The intermediary then communicates with the online vendor and supplies intermediary payment information, e.g., a payment card number associated with the intermediary rather than the user, along with appropriate authorizing information and an alias destination address, e.g., a third party physical shipping address for deliverable goods, an alias electronic address for downloadable material, etc. The online vendor charges the purchase to the intermediary, and redirects the delivery of the goods or services to the destination address provided by the intermediary. The intermediary charges the payment card number of the user, and arranges for the redirection of the delivery to the real user address. In this manner, the invention provides complete end-to-end anonymity for the user, even when the user desires to enter transactions involving purchase and receipt of deliverable goods and services.

Owner:LIVESAY PAUL OWEN

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com