Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

869 results about "Electronic trading" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Electronic trading, sometimes called etrading, is a method of trading securities, foreign exchange or financial derivatives electronically. Information technology is used to bring together buyers and sellers through an electronic trading platform and network to create virtual market places such as NASDAQ, NYSE Arca and Globex which are also known as electronic communication networks. Electronic trading is rapidly replacing human trading in global securities markets. Electronic trading is in contrast to older floor trading and phone trading and has a number of advantages, but glitches and cancelled trades do still occur.

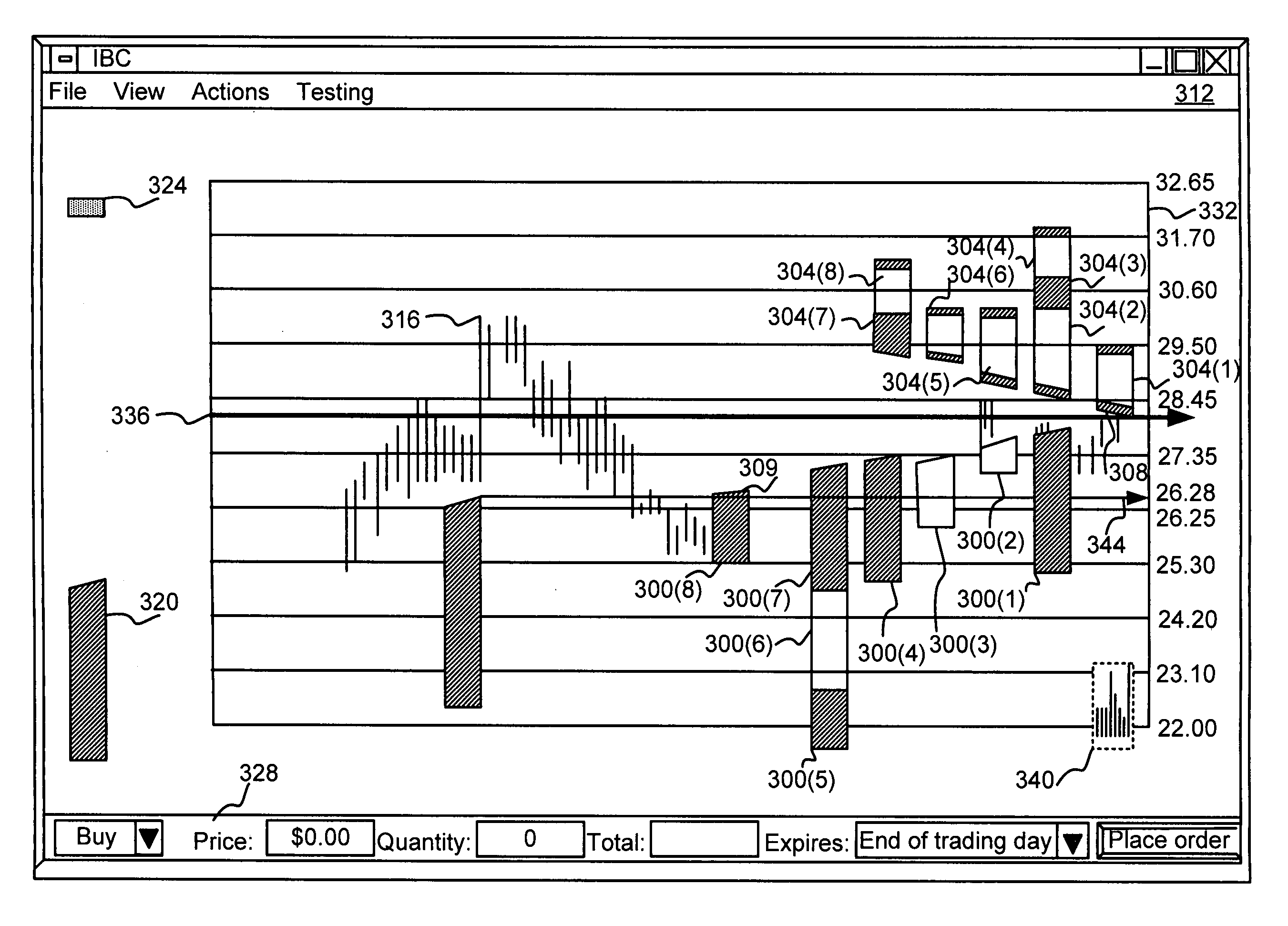

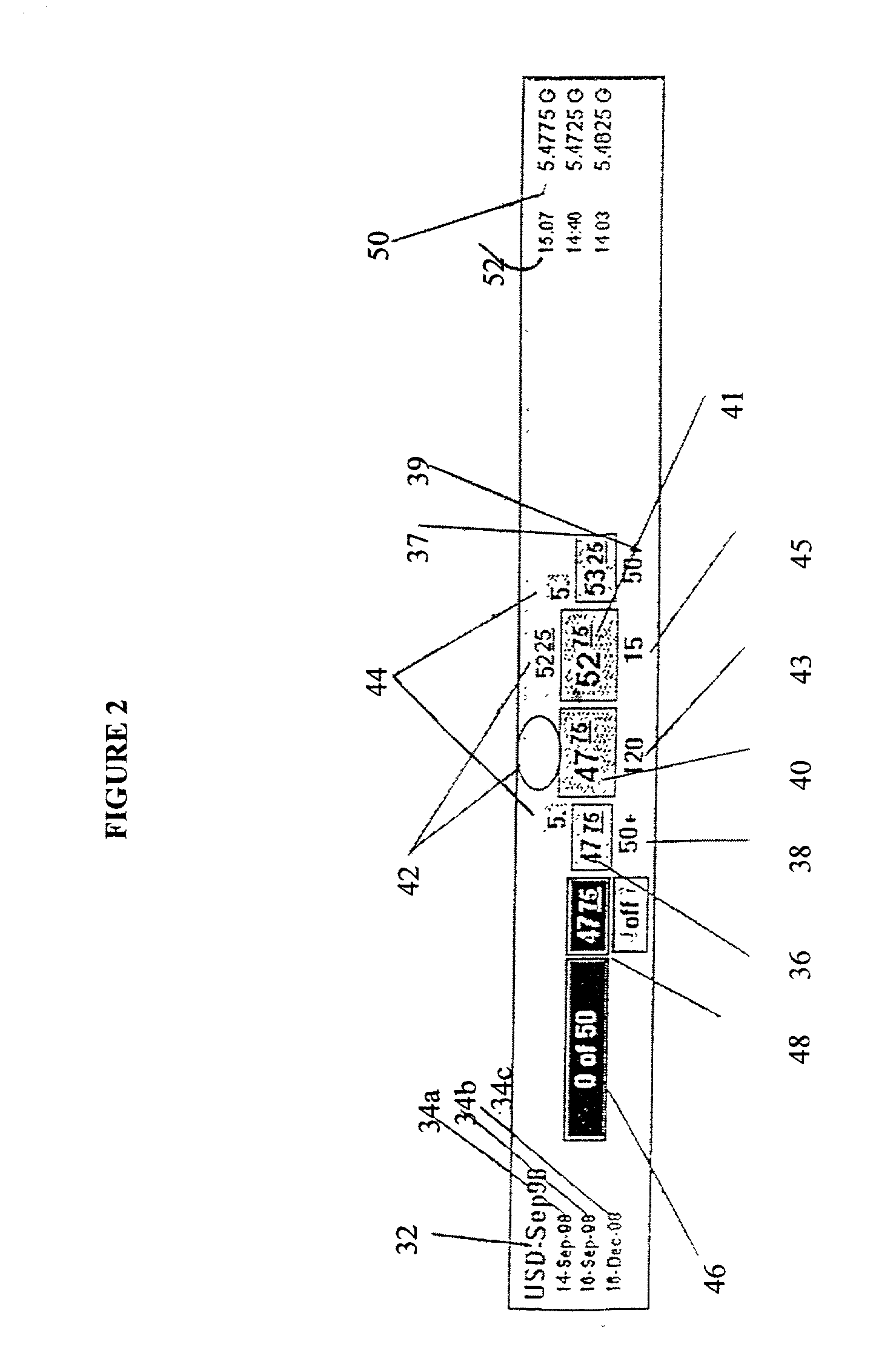

Click based trading with intuitive grid display of market depth and price consolidation

InactiveUS7127424B2Shorten the timeLarge rangeFinanceAdvertisementsComputer scienceElectronic trading

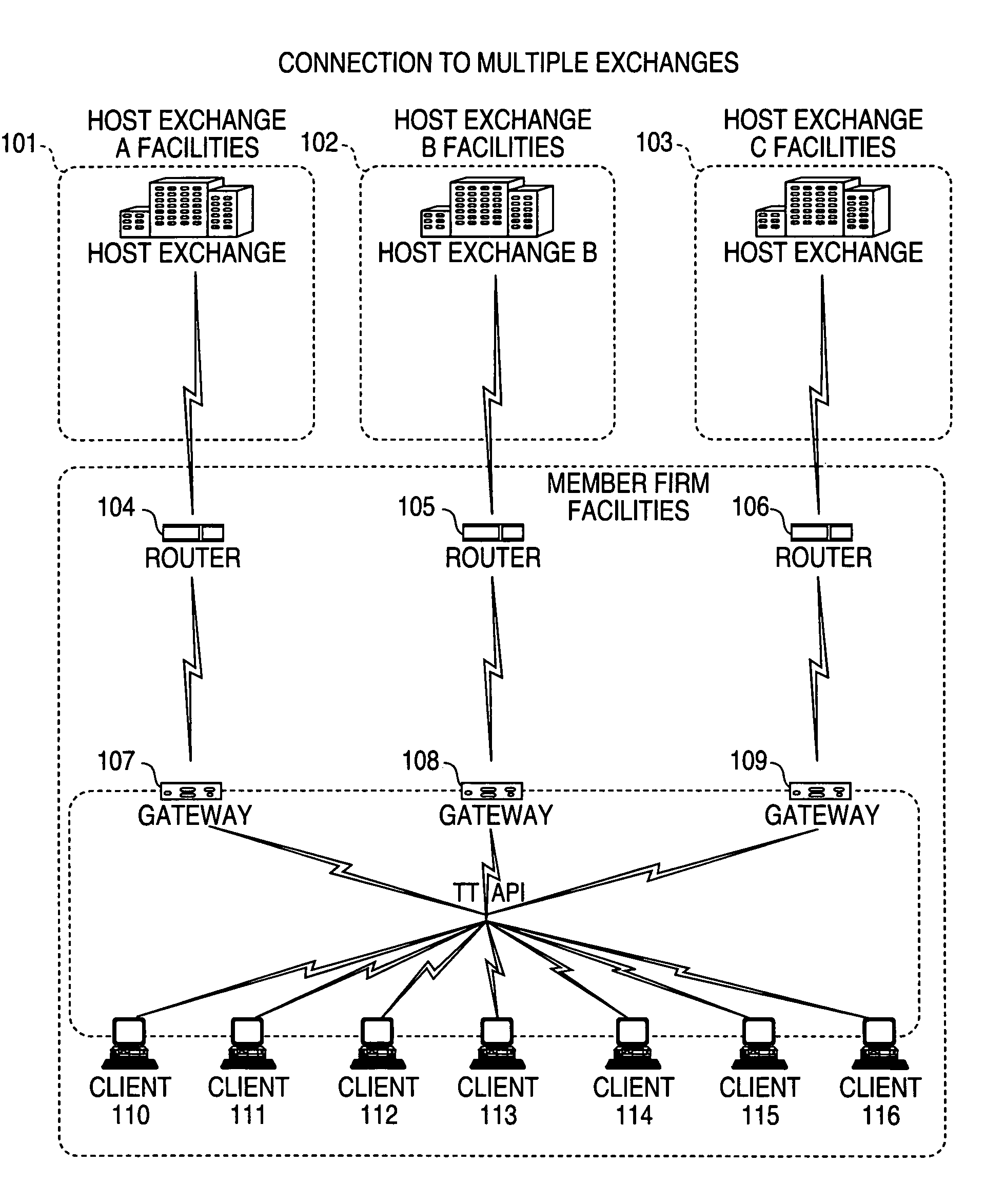

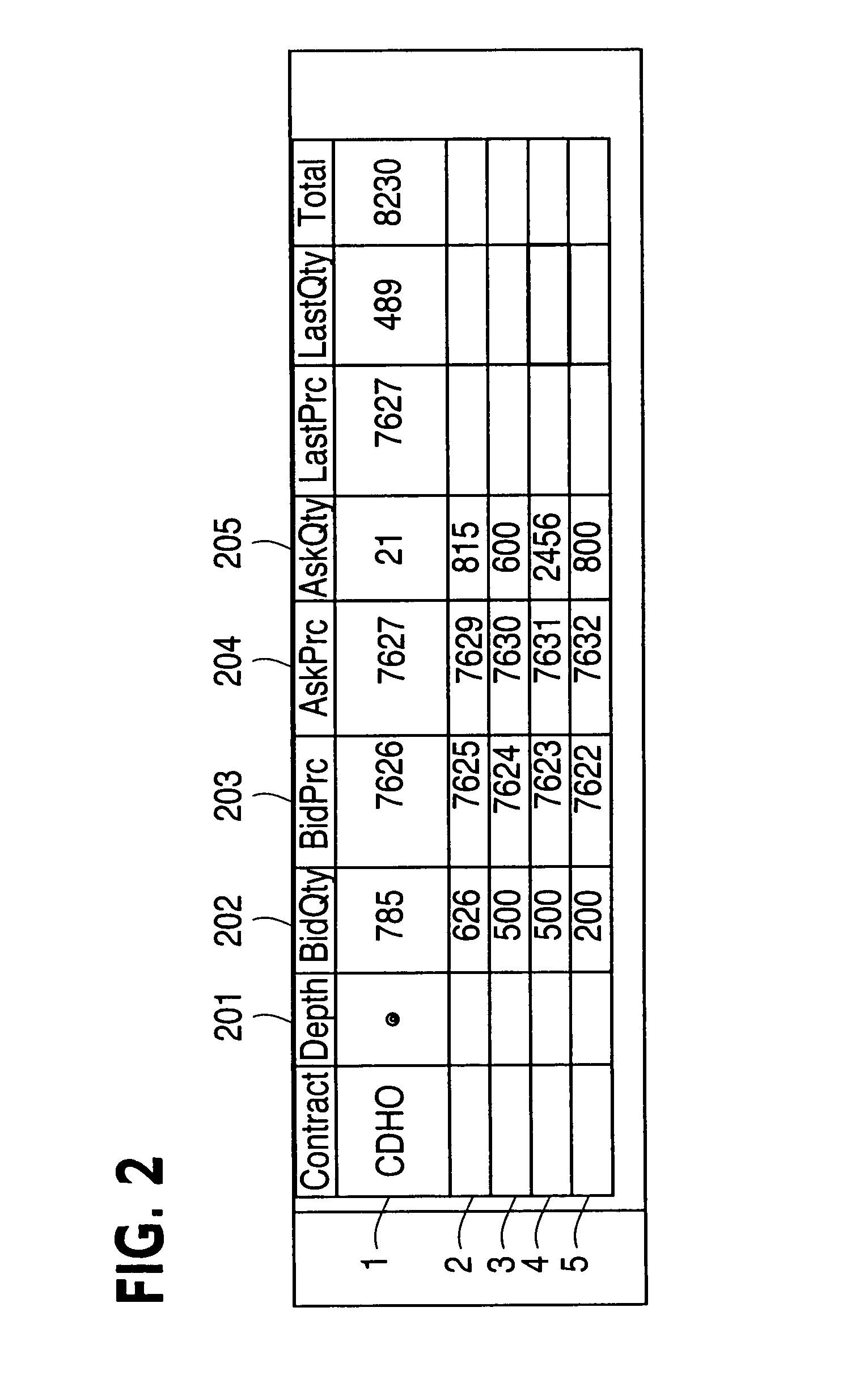

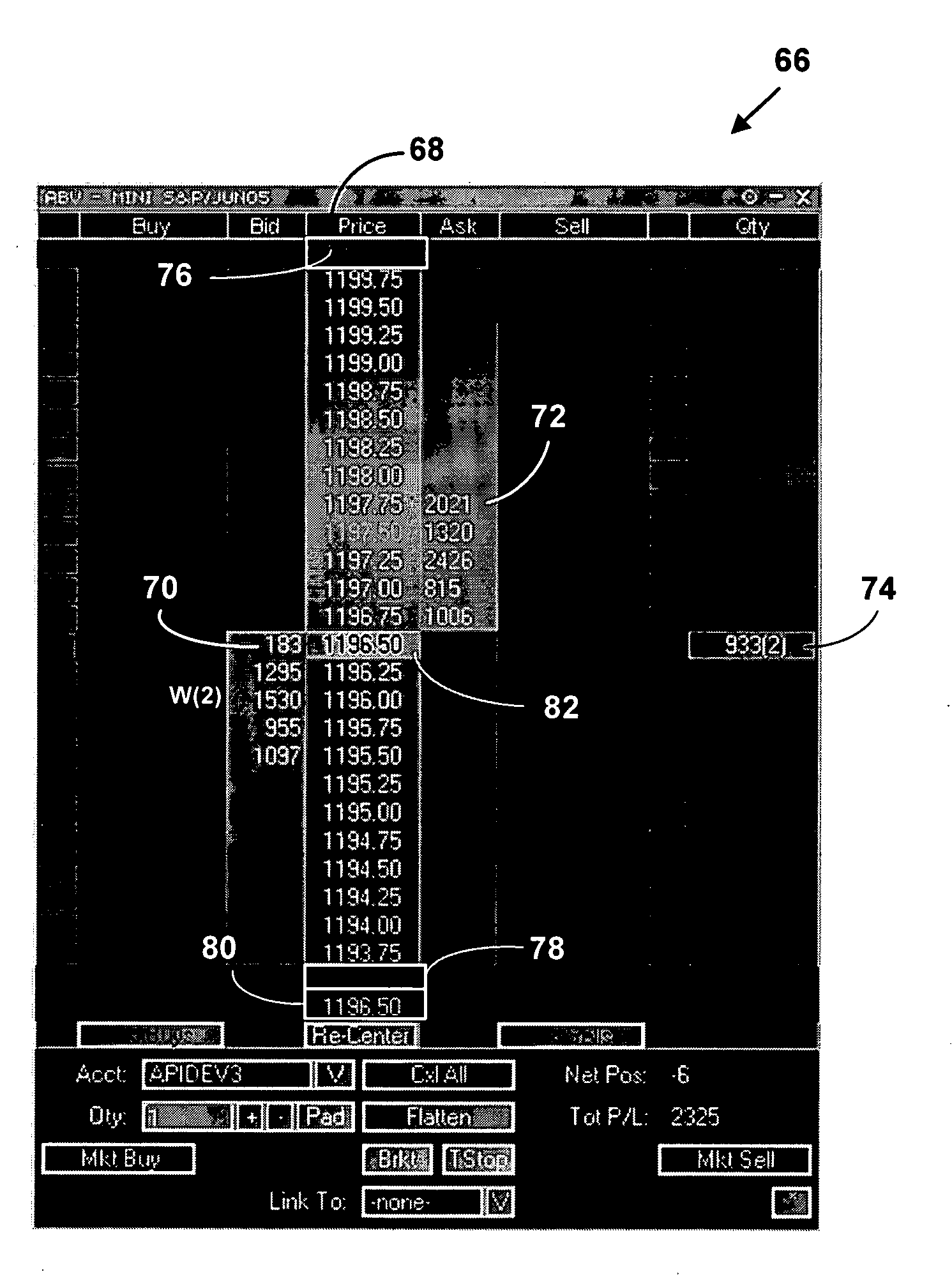

A method and system for reducing the time it takes for a trader to place a trade when electronically trading on an exchange, thus increasing the likelihood that the trader will have orders filled at desirable prices and quantities. The “Mercury” display and trading method of the present invention ensure fast and accurate execution of trades by displaying market depth on a vertical or horizontal plane, which fluctuates logically up or down, left or right across the plane as the market prices fluctuate. This allows the trader to trade quickly and efficiently. The price consolidation feature of the present invention, as described herein, enables a trader to consolidate a number of prices in order to condense the display. Such action allows a trader to view a greater range of prices and a greater number of orders in the market at any given time. By consolidating prices, and therefore orders, a trader reduces the risk of a favorable order scrolling from the screen prior to filling a bid or ask on that order at a favorable price.

Owner:TRADING TECH INT INC

Automated trading system in an electronic trading exchange

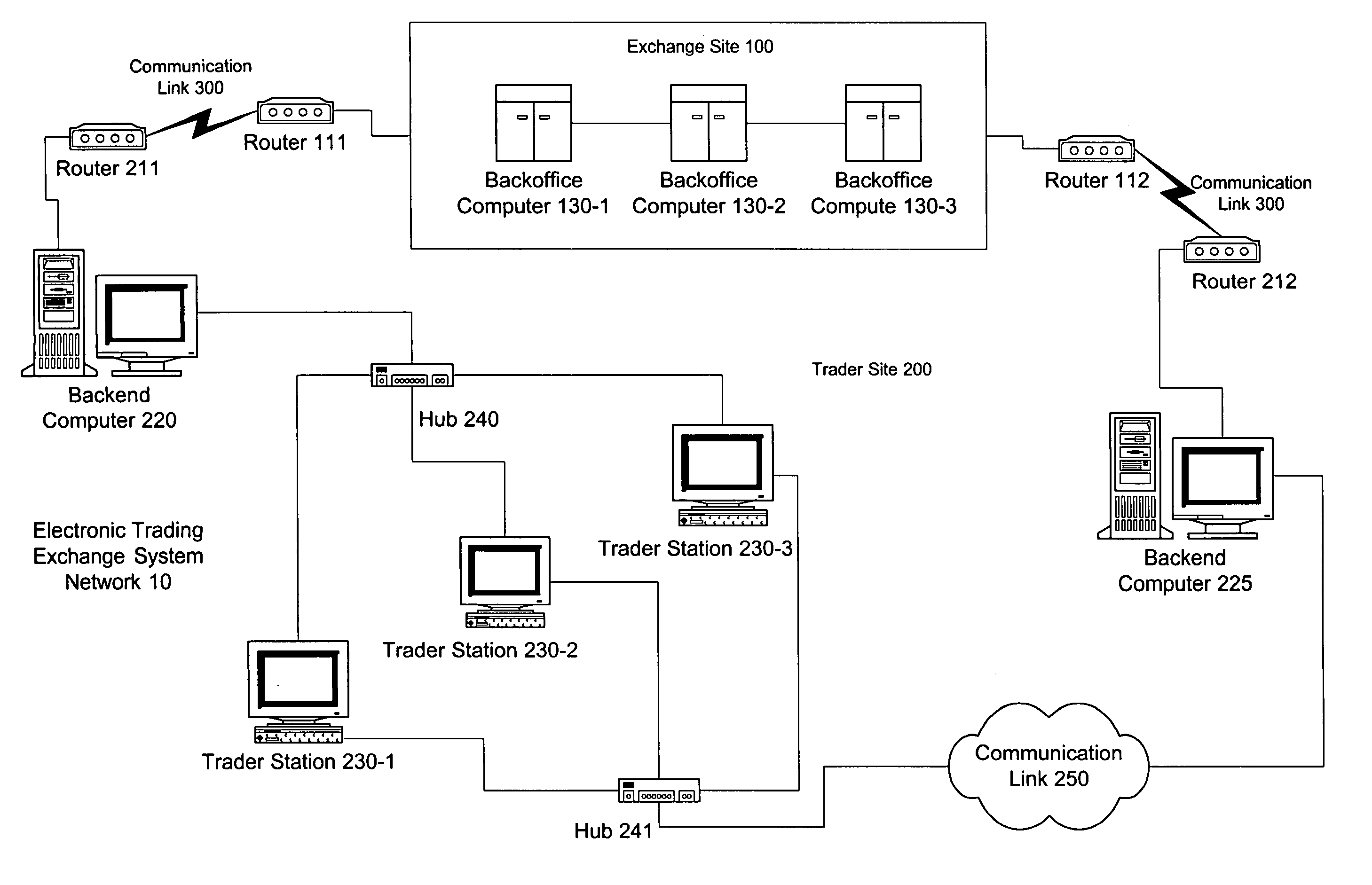

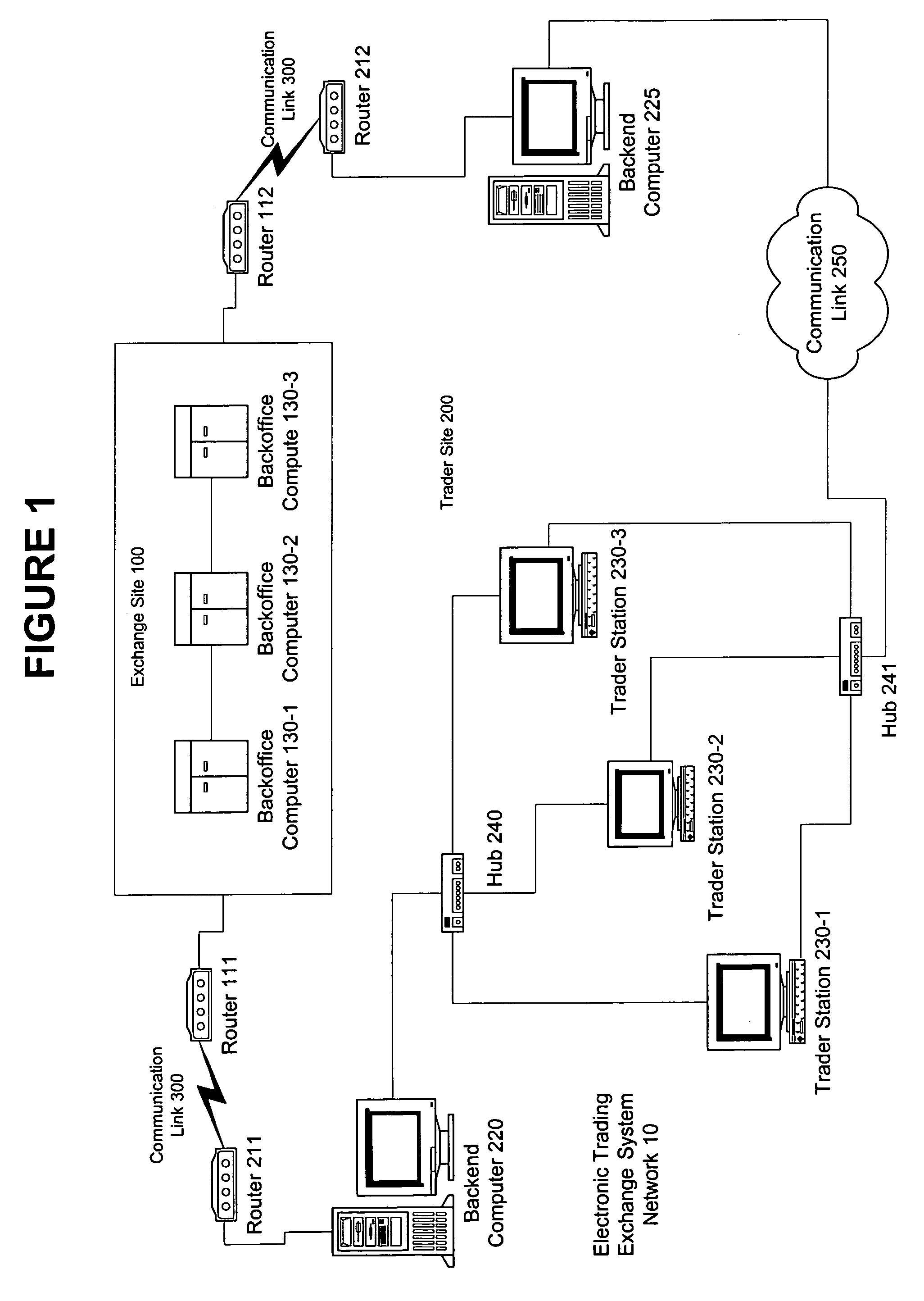

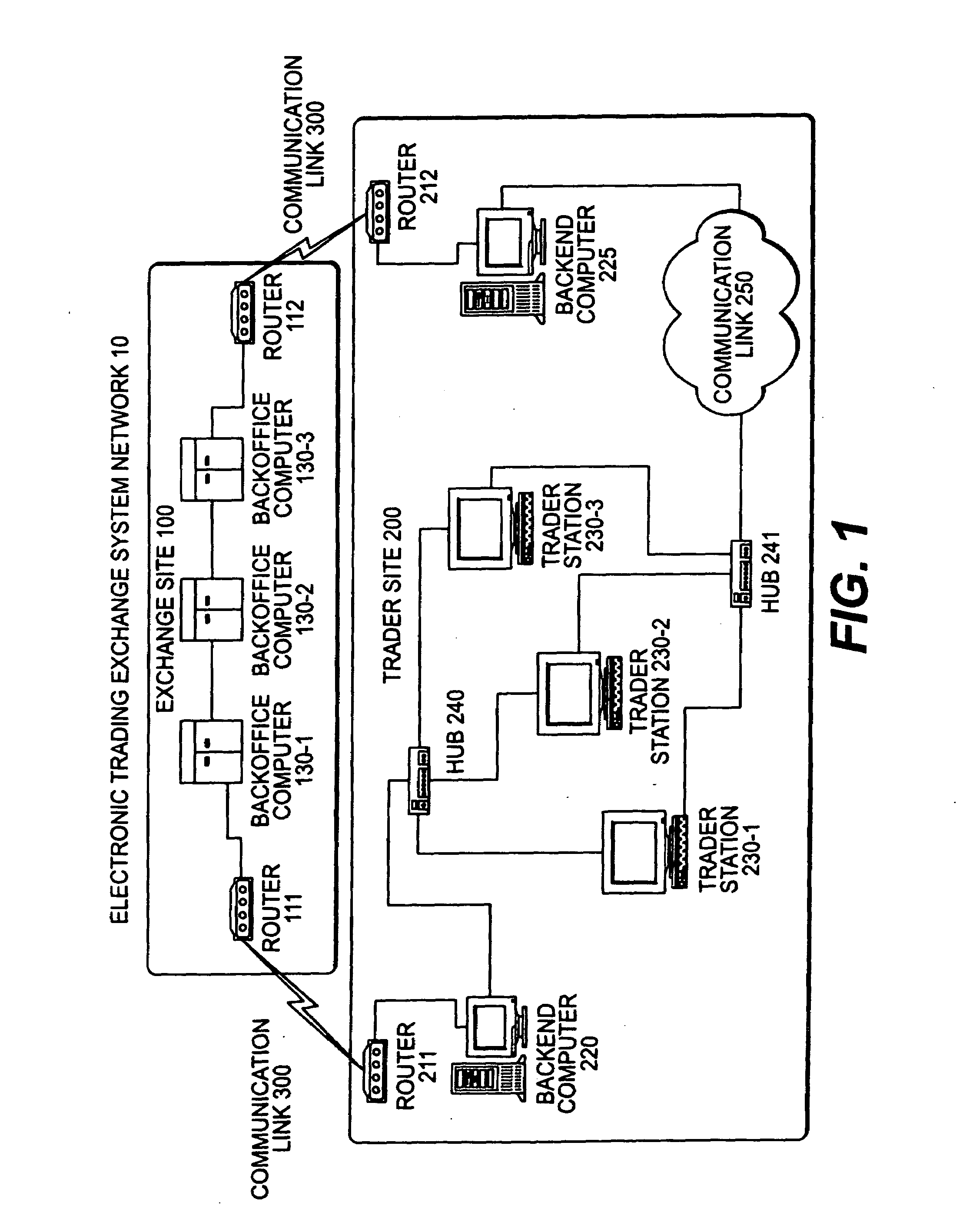

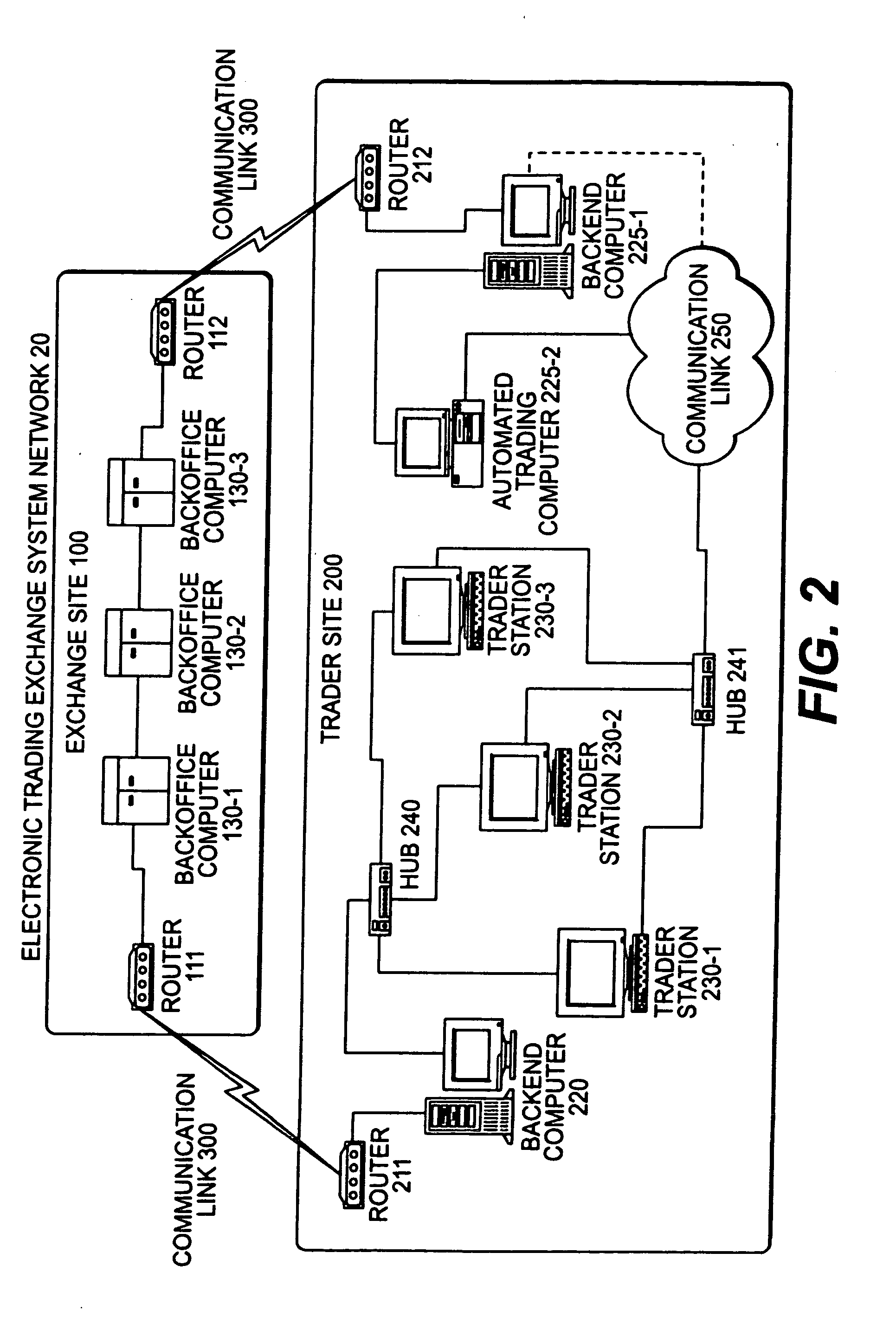

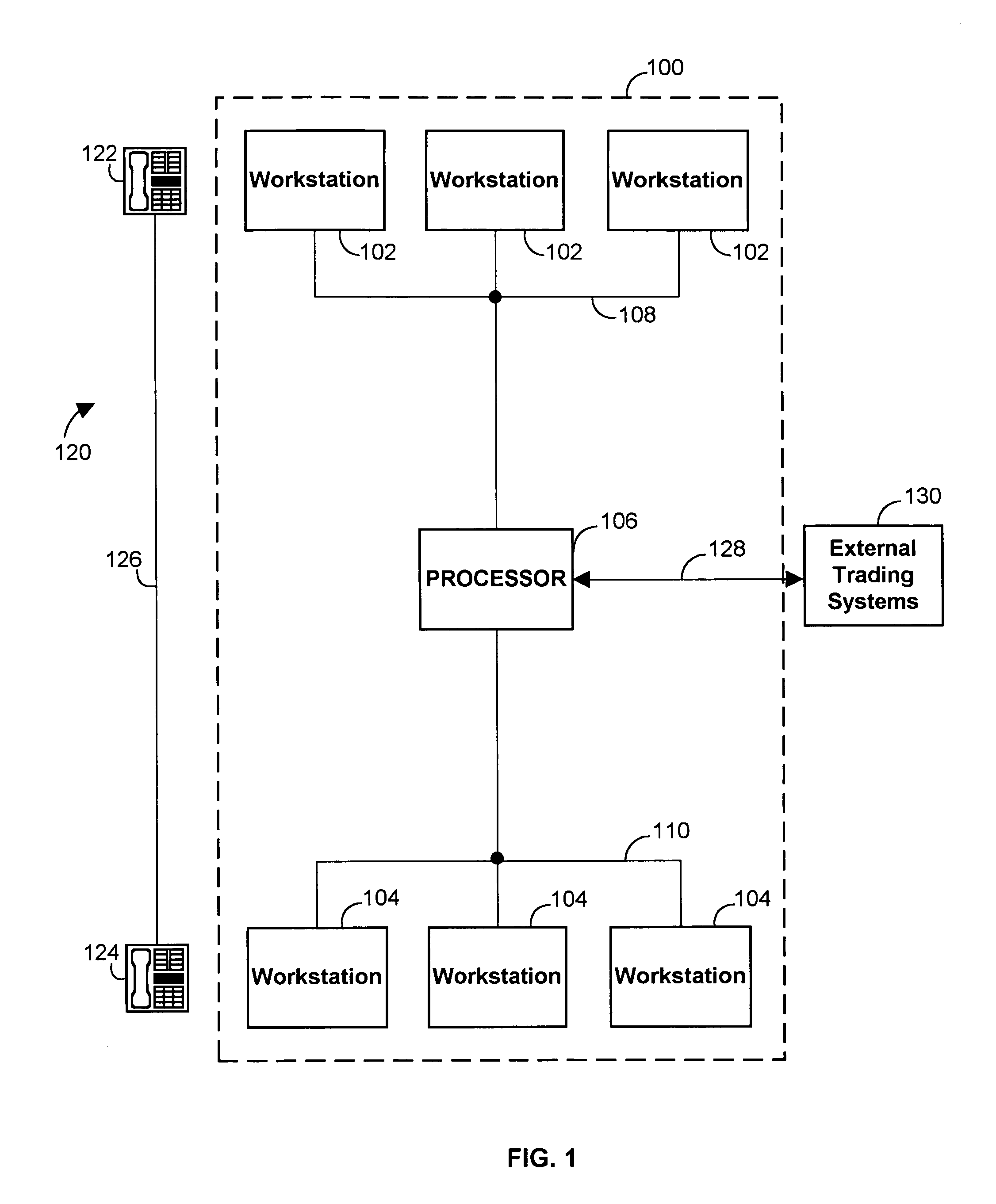

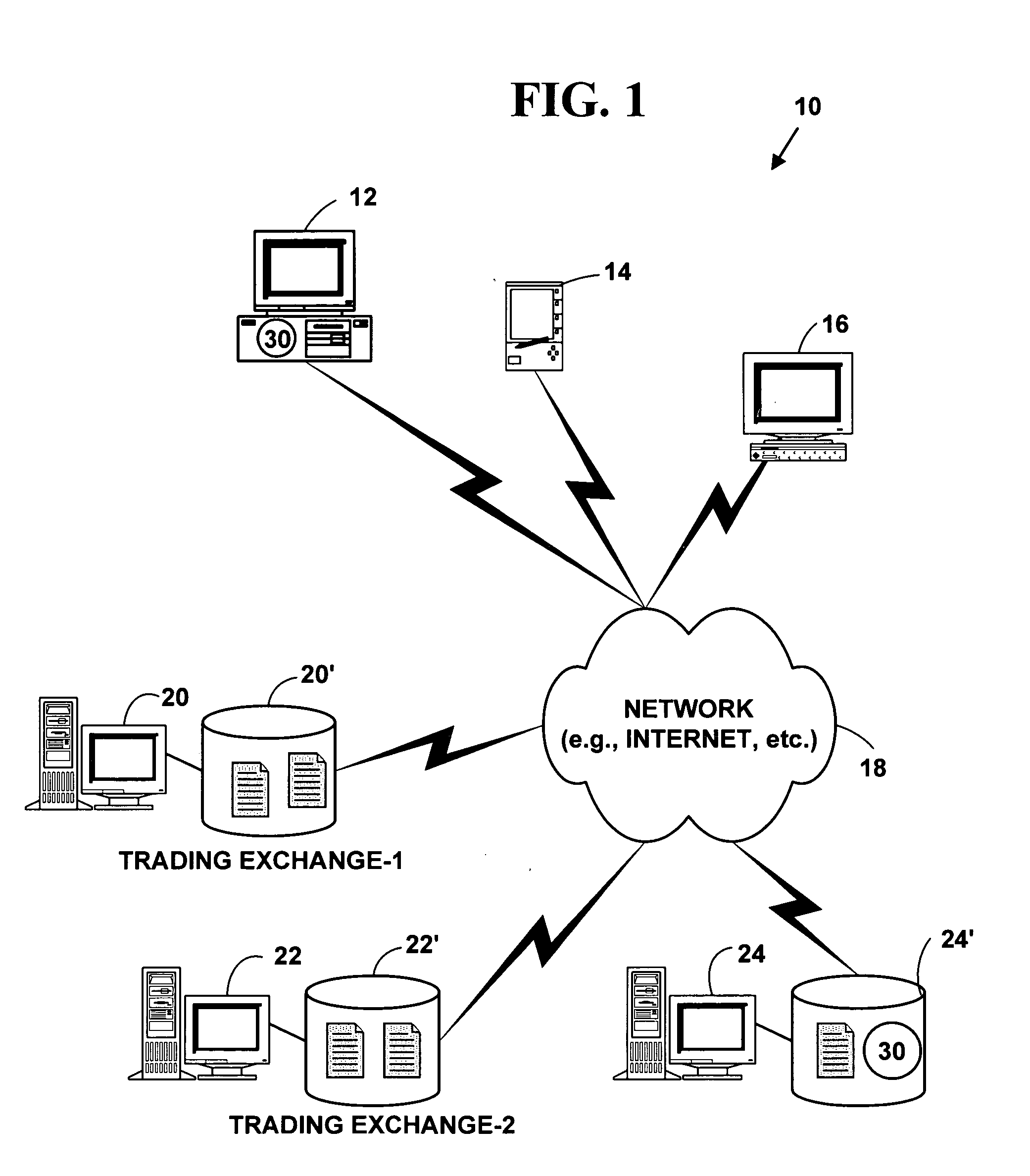

An electronic exchange system network includes a trader site having an automated trading system capable of submitting orders and / or quotes to an exchange site. The automated trading system determines whether an order or quote should be submitted based on, for example, the current market price of an option and theoretical buy and sell prices. The theoretical buy and sell prices are derived from, among other things, the current market price of the security underlying the option. The theoretical buy and sell prices are calculated when underlying factors that contribute to the theoretical prices change. Computation times of the theoretical prices may be reduced by using precalculated values and / or using interpolation and extrapolation. Other techniques may be used in addition or in the alternative to speed automatic decision-making. In addition, a system of checks may be conducted to ensure accurate and safe automated trading. The automated trading system may be capable of automatically submitting orders in connection with the underlying security in order to hedge part of the delta risk associated with the automated option trades.

Owner:DCFB

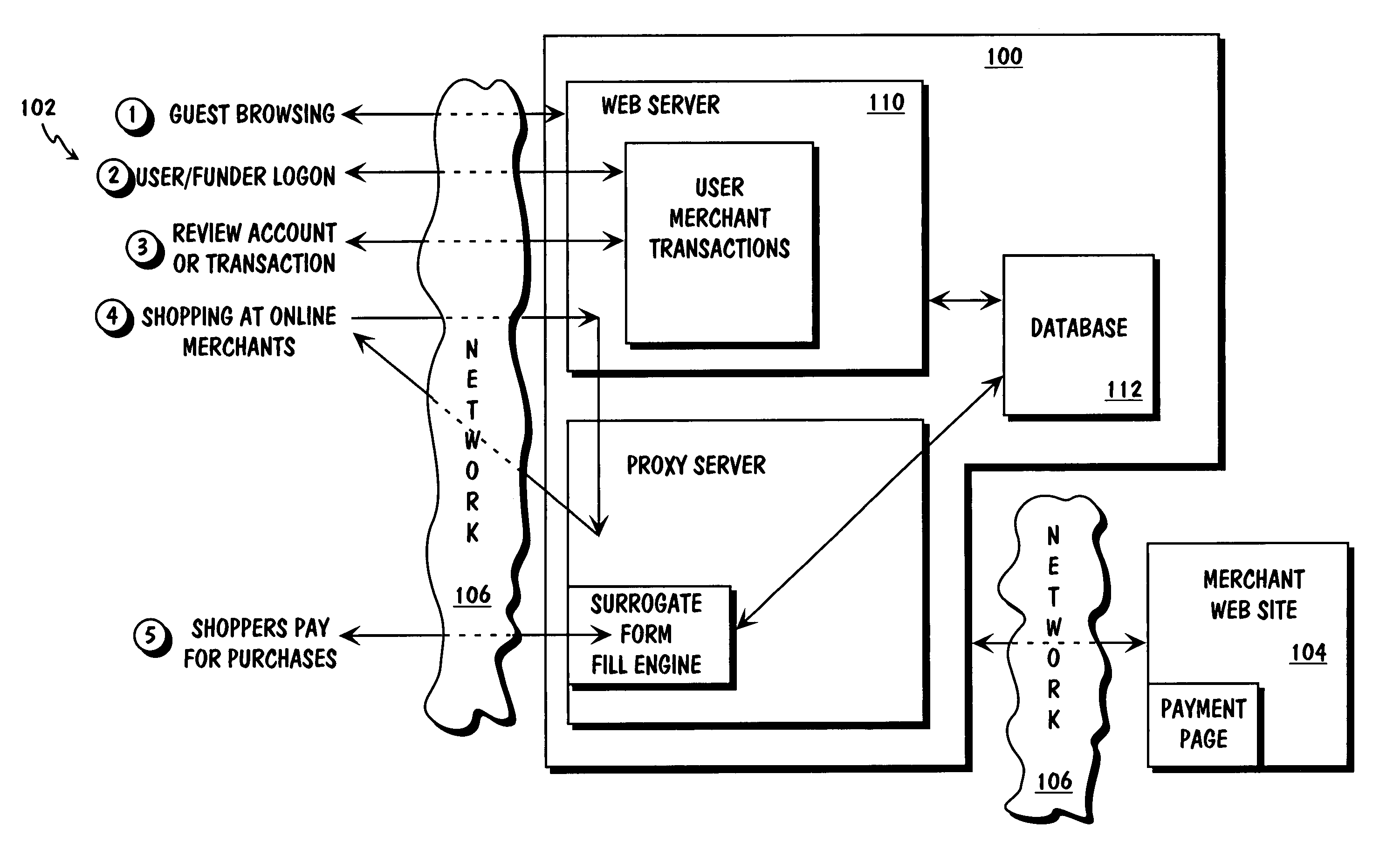

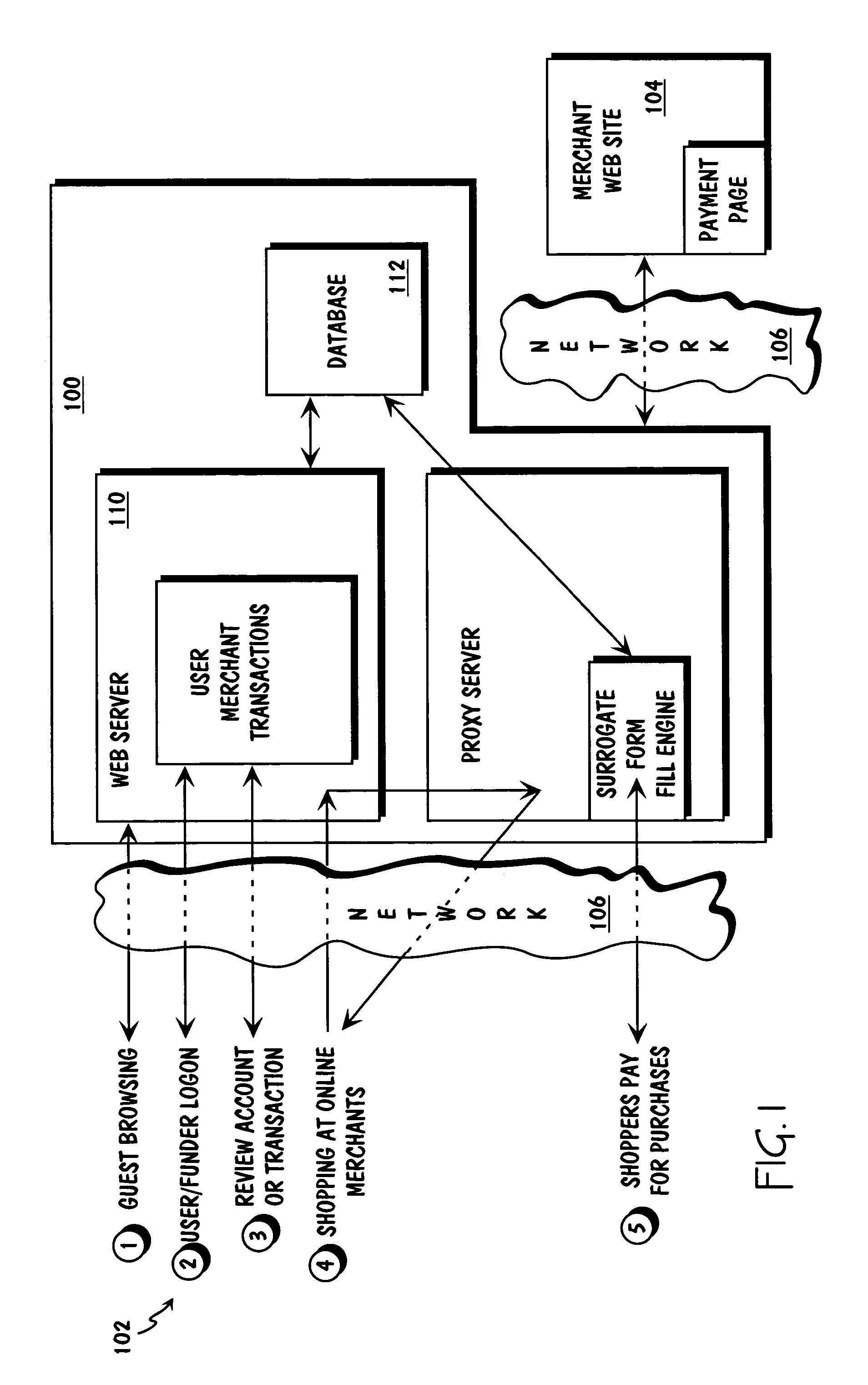

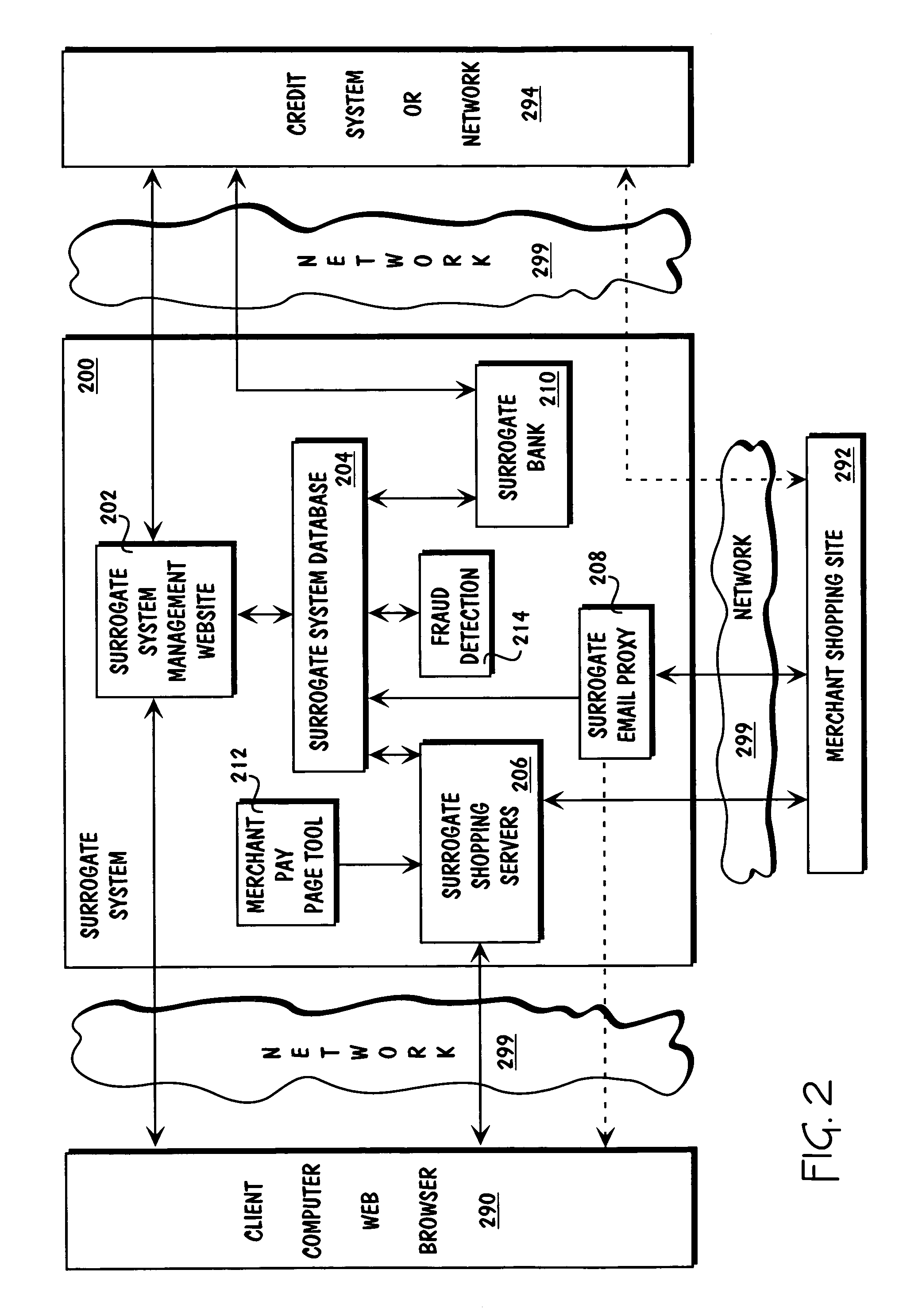

Method and apparatus for surrogate control of network-based electronic transactions

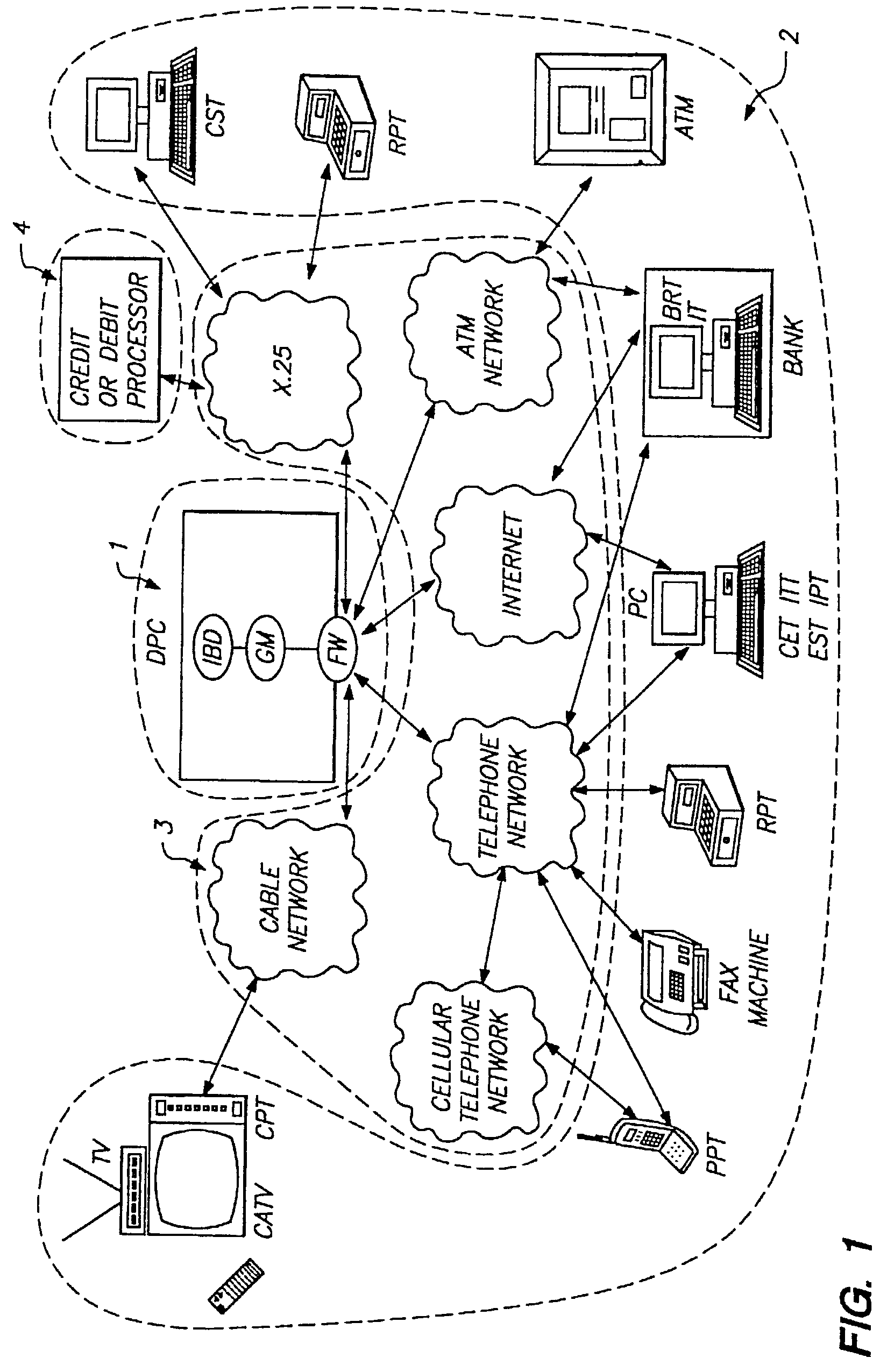

A surrogate system for the transparent control of electronic commerce transactions is provided through which an individual without a credit card is enabled to shop at online merchant sites. Upon opening an account within the surrogate system, the account can be funded using numerous fund sources, for example credit cards, checking accounts, money orders, gift certificates, incentive codes, online currency, coupons, and stored value cards. A user with a funded account can shop at numerous merchant web sites through the surrogate system. When merchandise is selected for purchase, a purchase transaction is executed in which a credit card belonging to the surrogate system is temporarily or permanently assigned to the user. The credit card, once loaded with funds from the user's corresponding funded account, is used to complete the purchase transaction. The surrogate system provides controls that include monitoring the data streams and, in response, controlling the information flow between the user and the merchant sites.

Owner:THE COCA-COLA CO

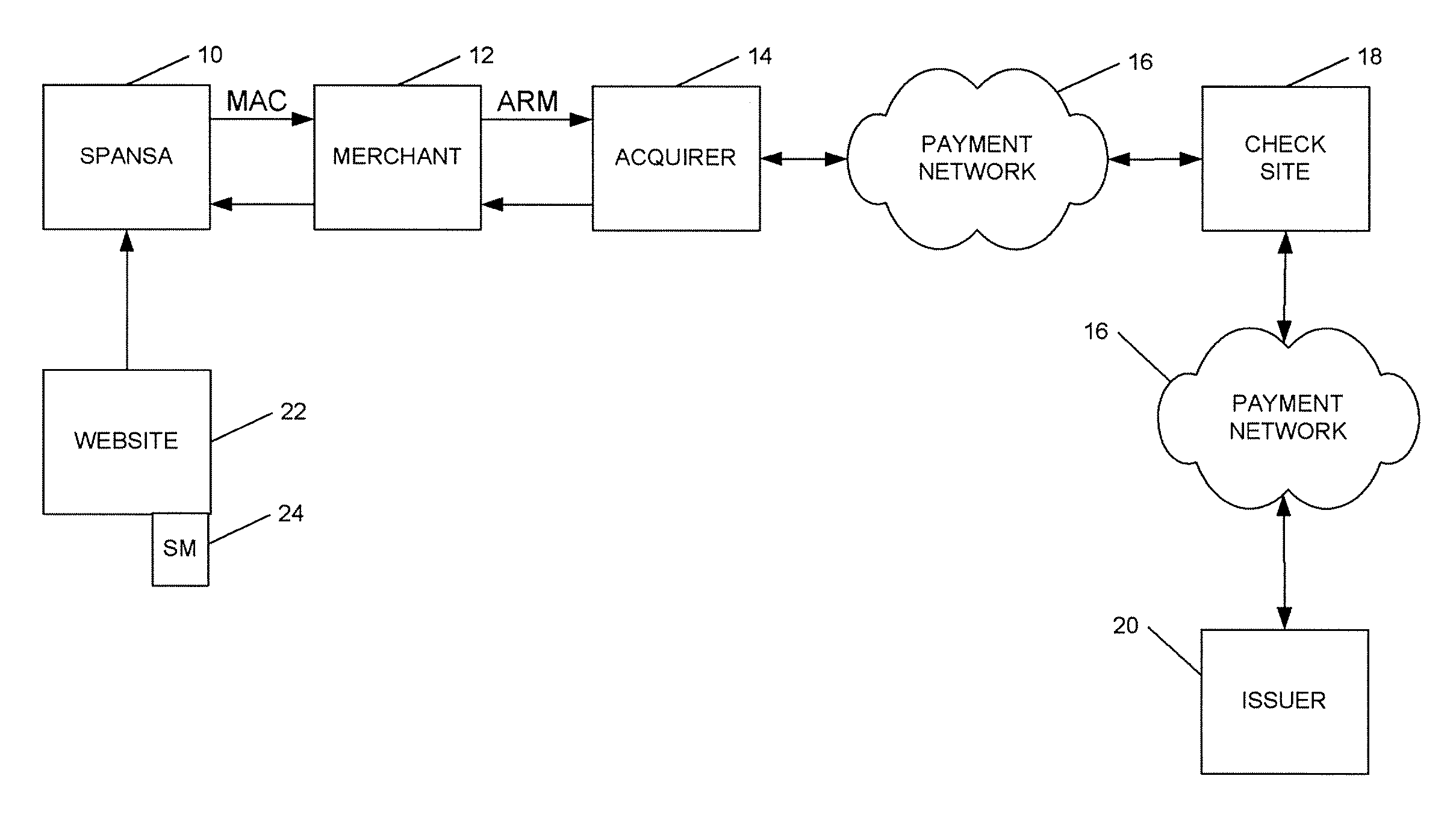

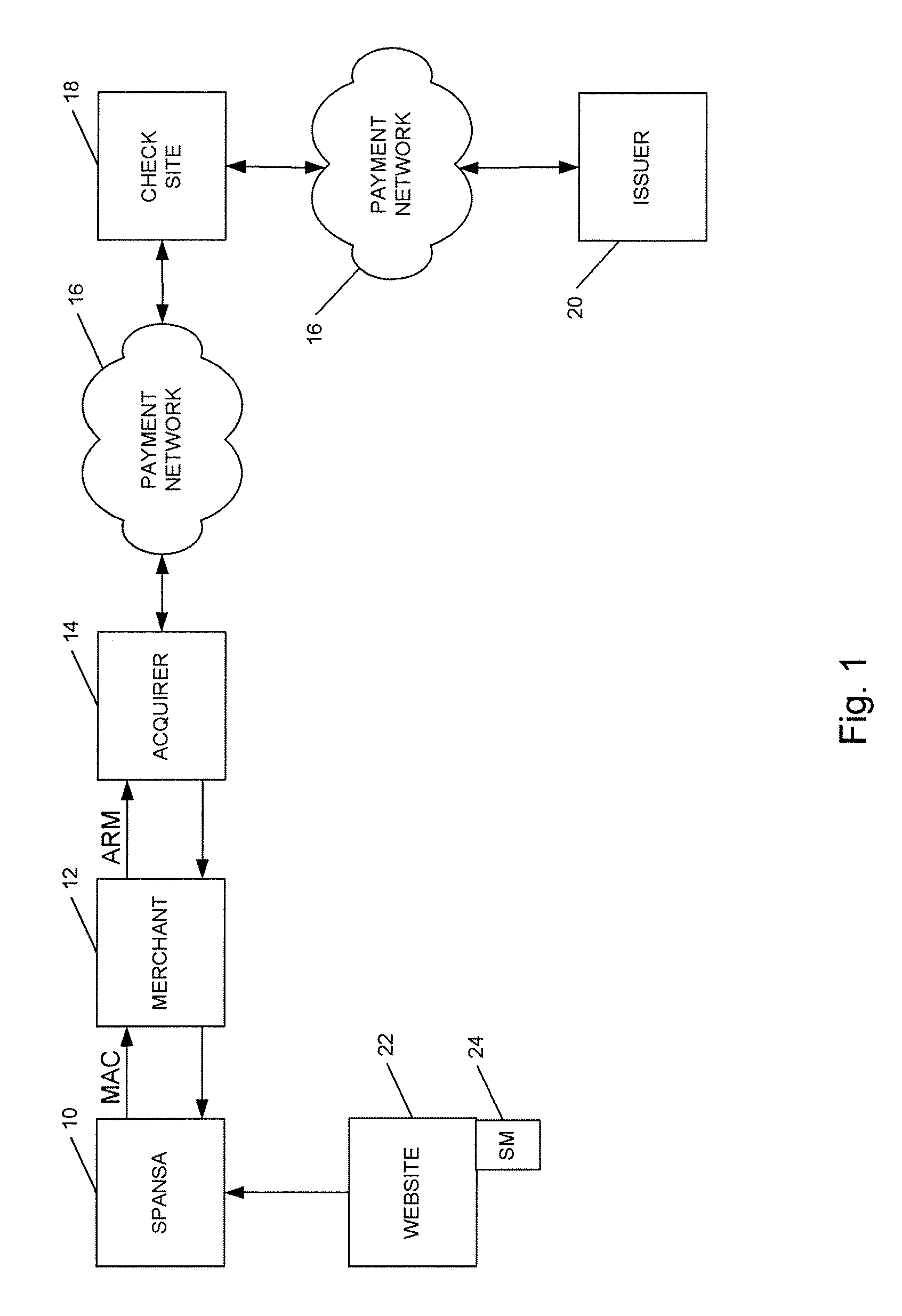

Method and system for conducting secure payments over a computer network without a pseudo or proxy account number

A method is provided for conducting an electronic transaction with a payment account number having a certain amount of available funds, using a payment network and a “check site”. The method comprises the following steps: (a) generating a secret key associated with the payment account number; (b) using the secret key to generate a message authentication code (“MAC”) specific to the transaction; (c) generating an authorization request message including the message authentication code; (d) forwarding the authorization request message over the payment network to the check site for verifying the authenticity of the MAC; (e) verifying the message authentication code by the check site using the secret key; (f) responding to the authorization request message over the payment network based on the available funds and the transaction amount.

Owner:MASTERCARD INT INC

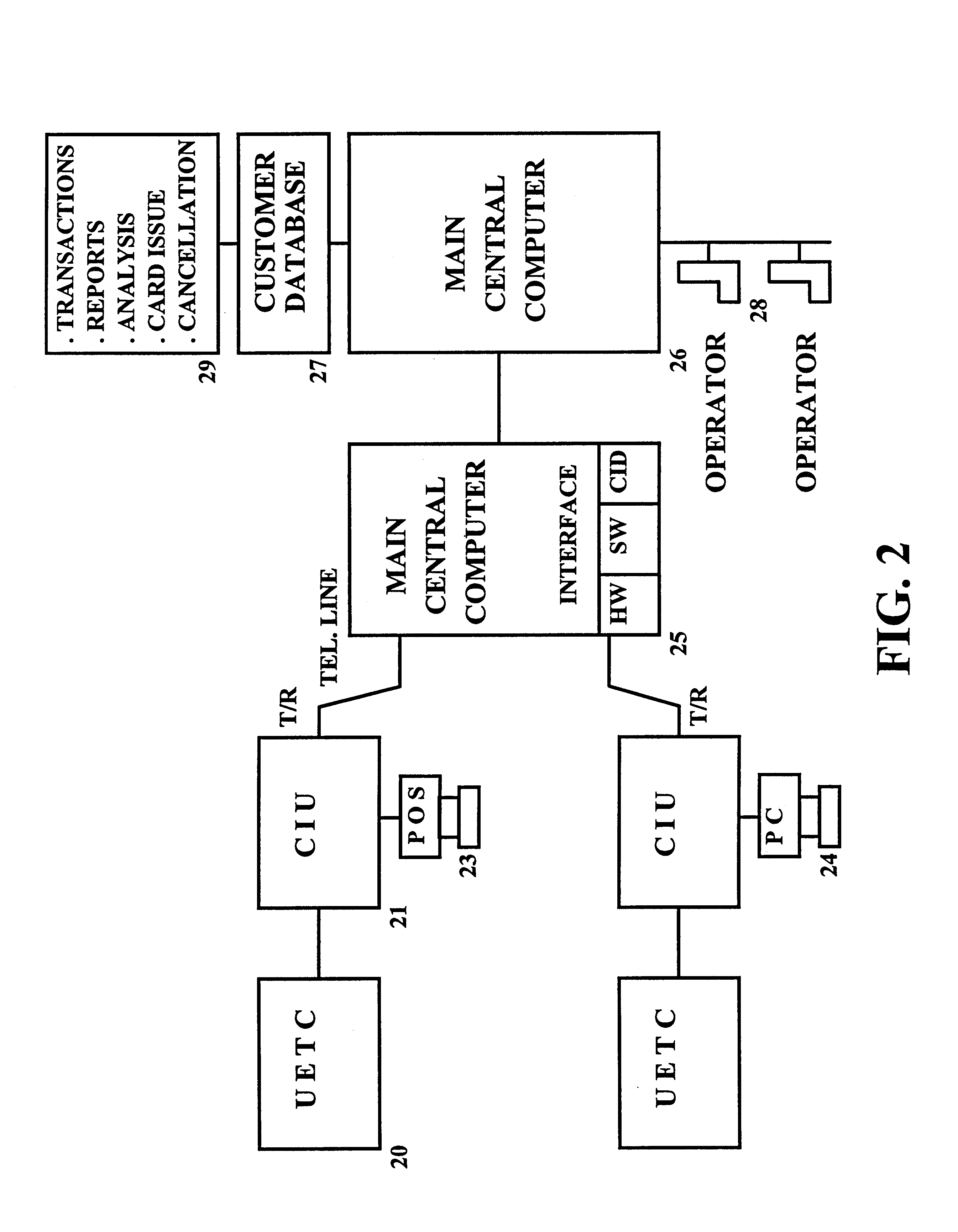

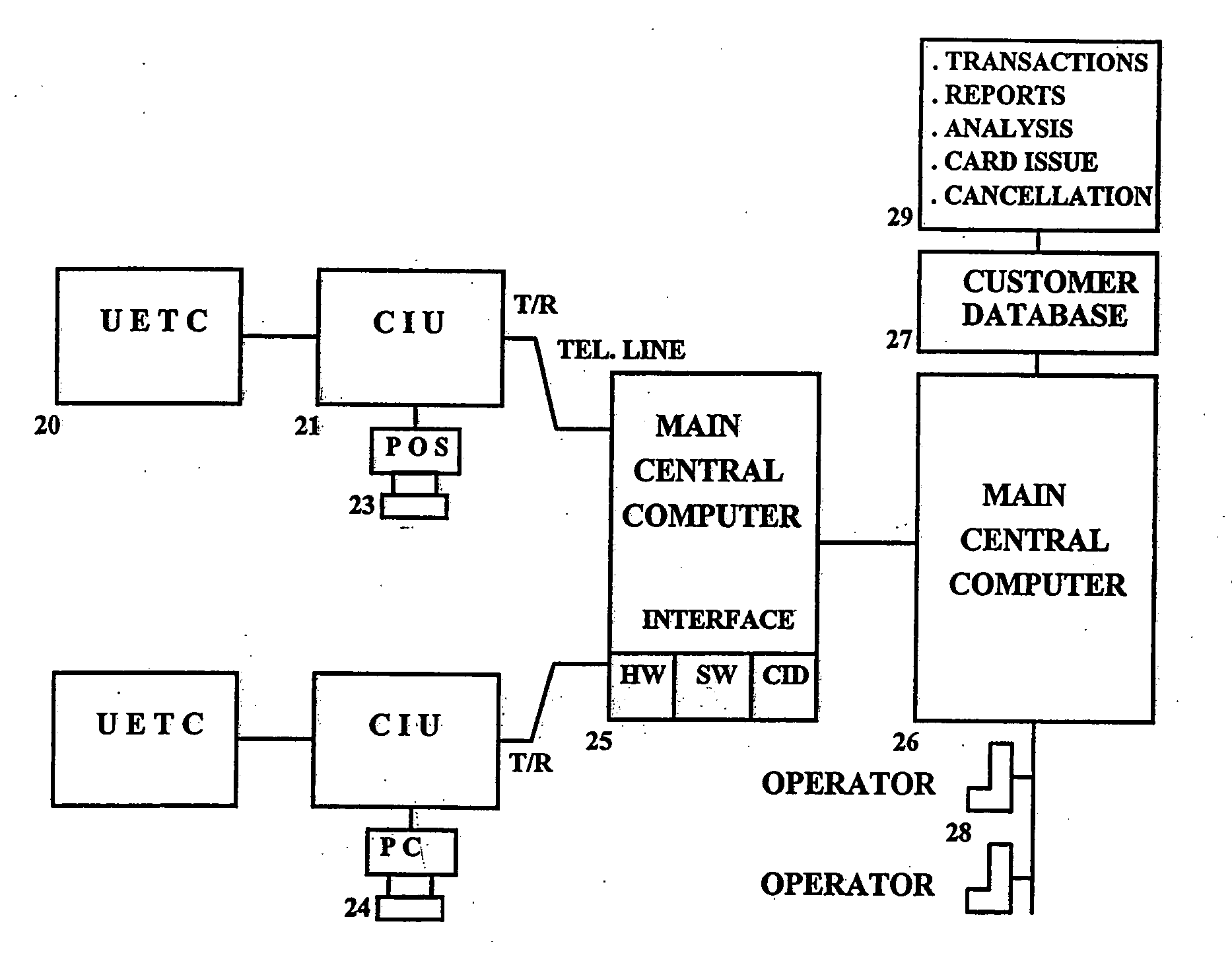

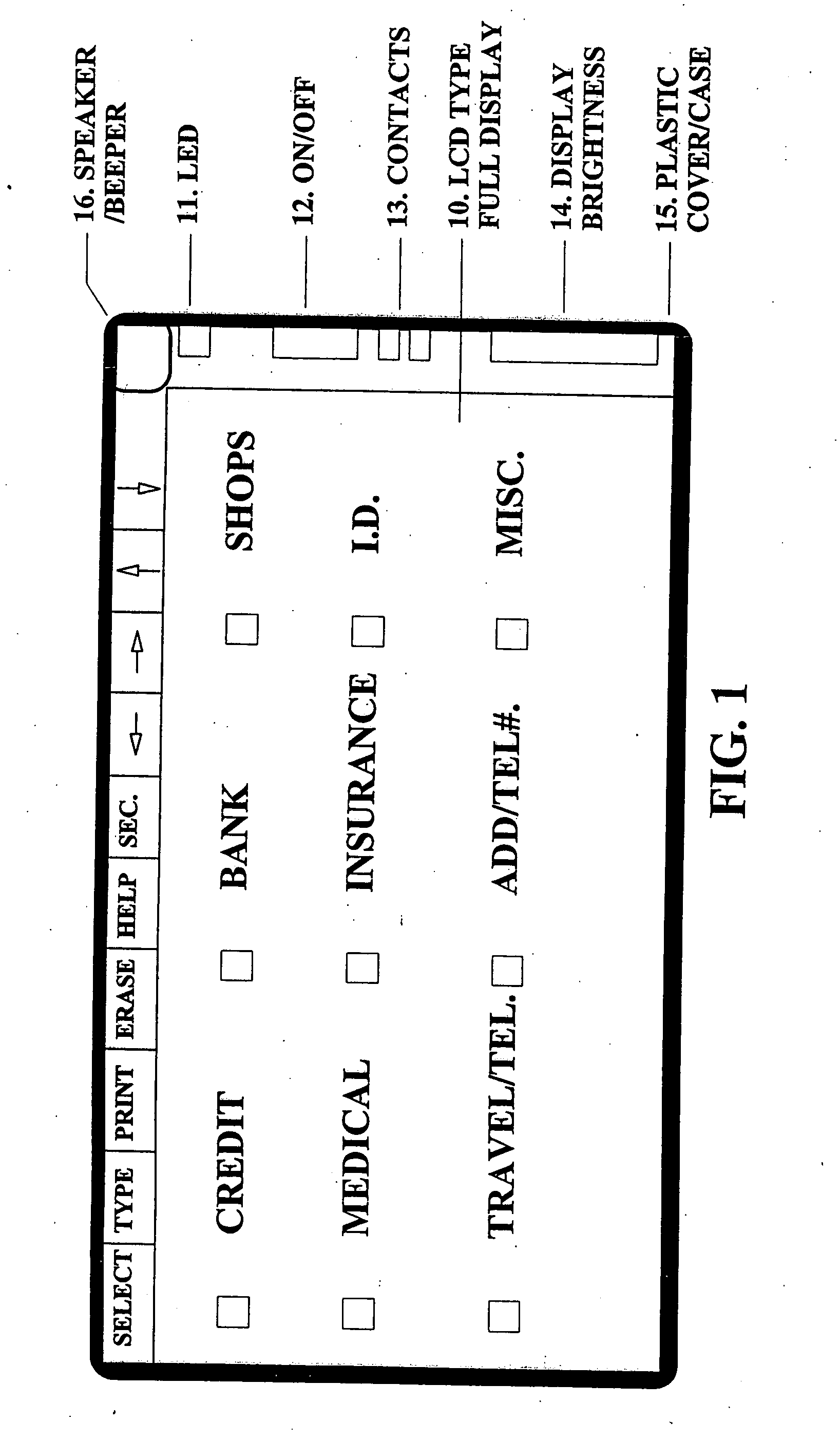

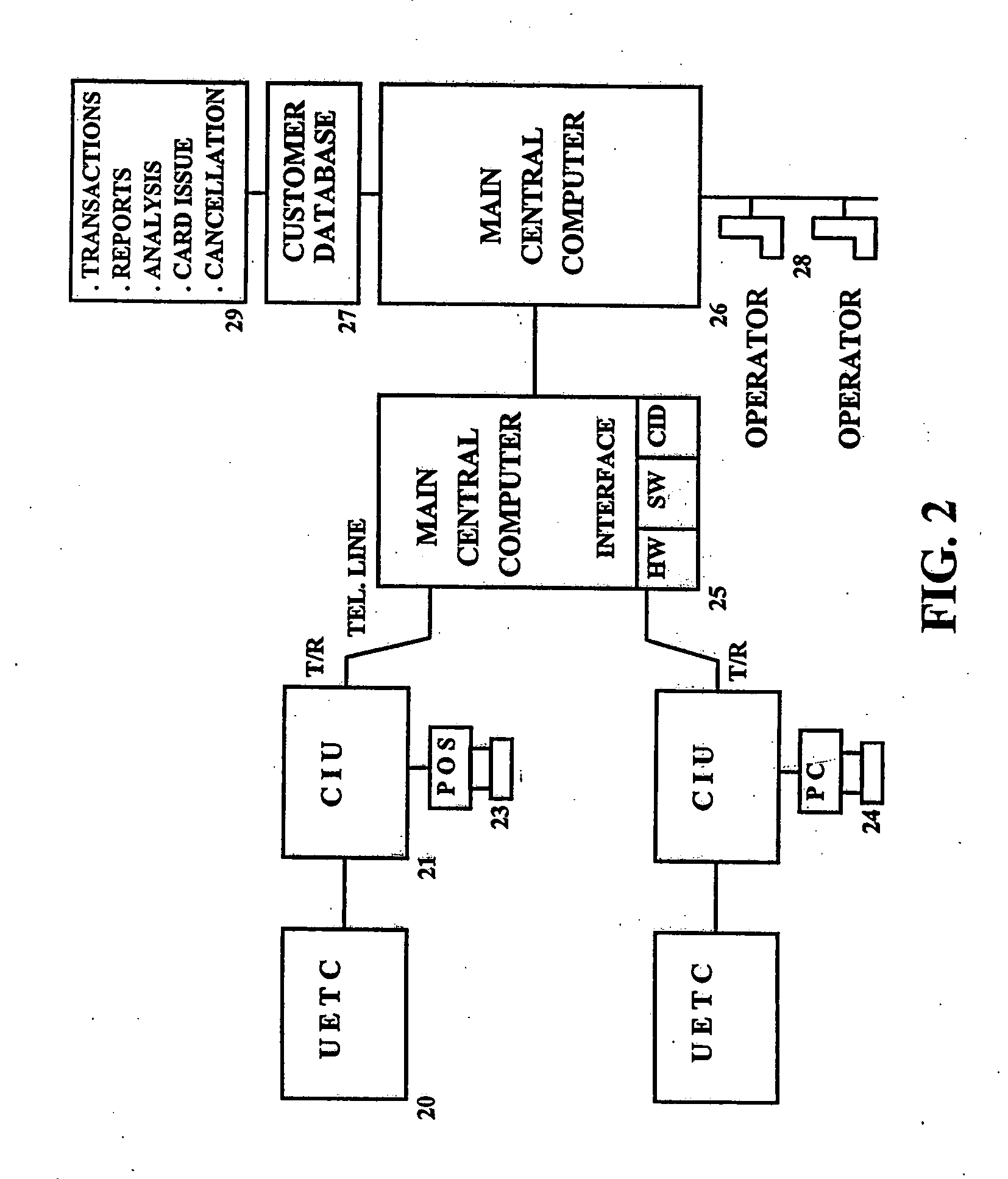

Device, system and methods of conducting paperless transactions

InactiveUS6925439B1Eliminate pointEliminate all paper transactions and billsFinancePayment circuitsPersonal computerComputer terminal

The invention also includes methods of issuing an account authorization to a UET card, a method of transferring transactional and account information between a UET card and a personal computer or a mainframe computer, a method of using the UET card as a remote terminal for a mainframe computer, and a method of conducting an electronic transaction.

Owner:C SAM INC

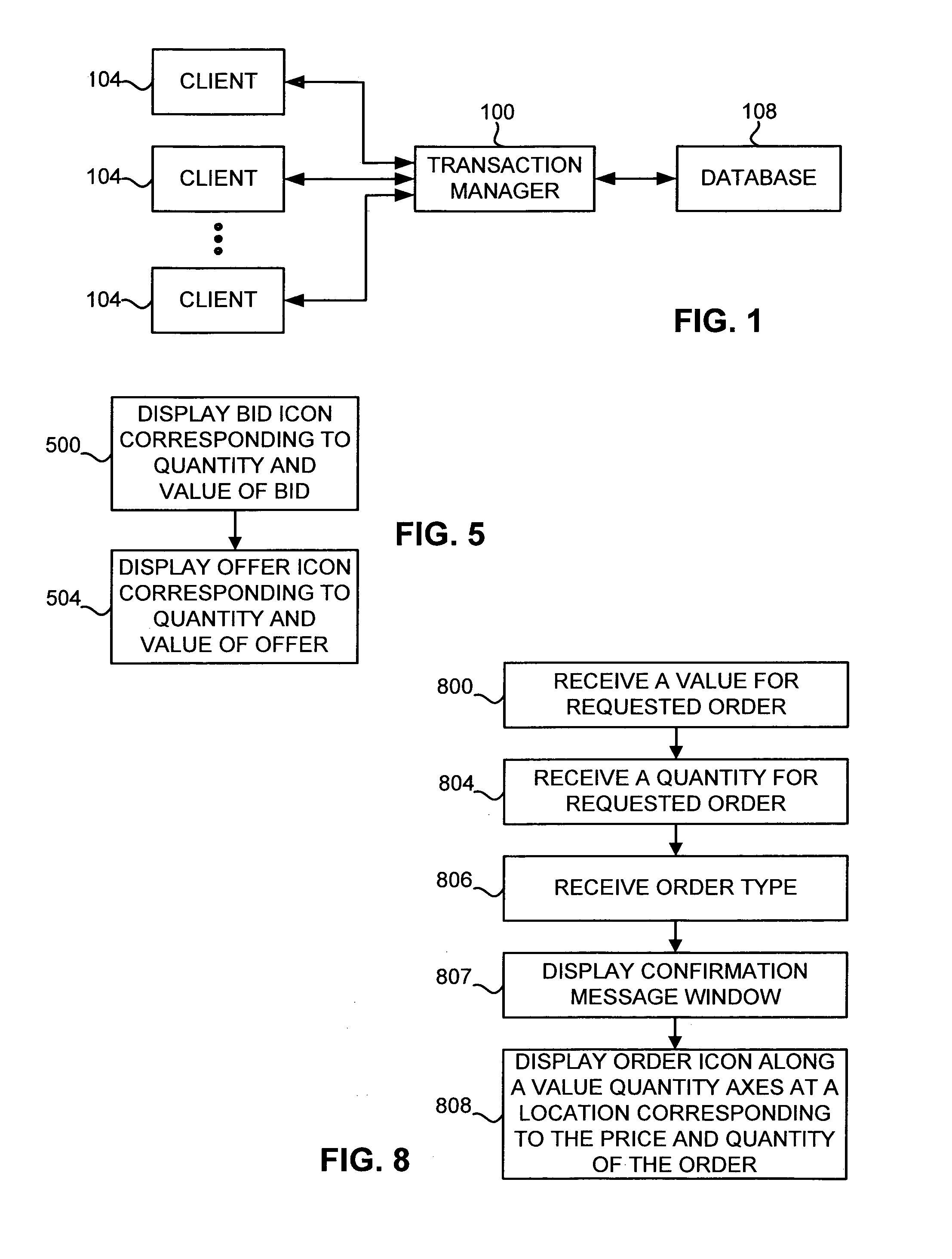

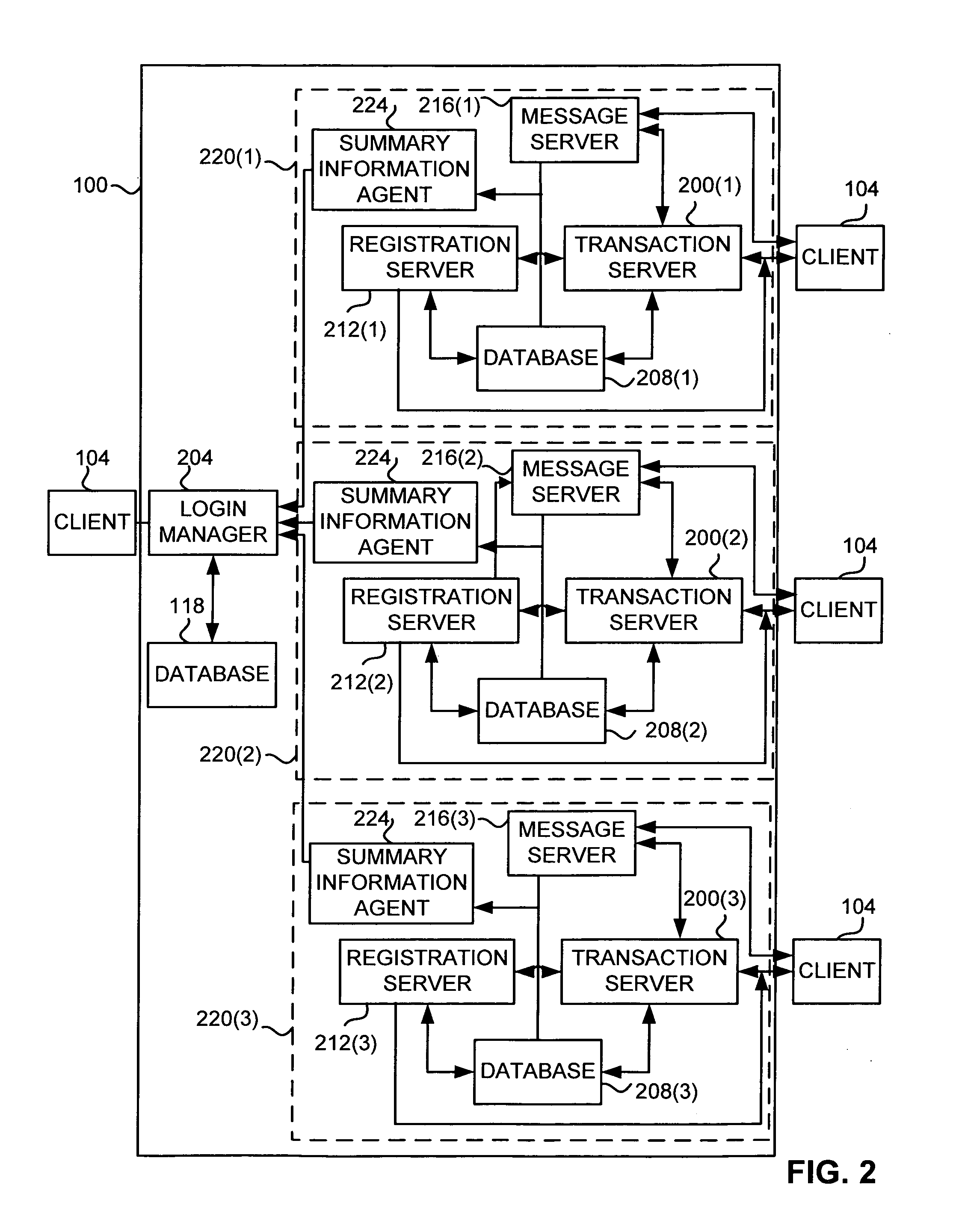

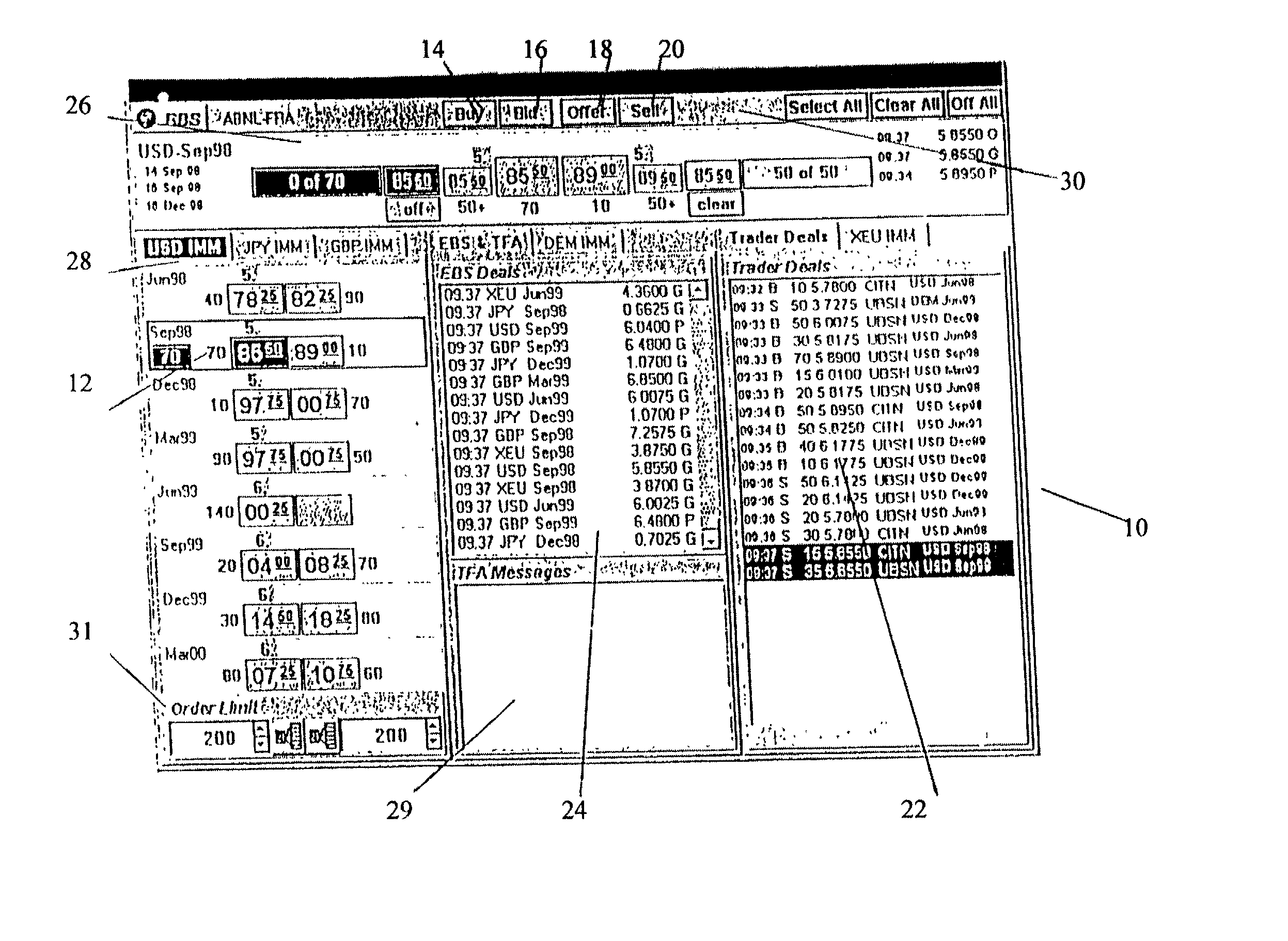

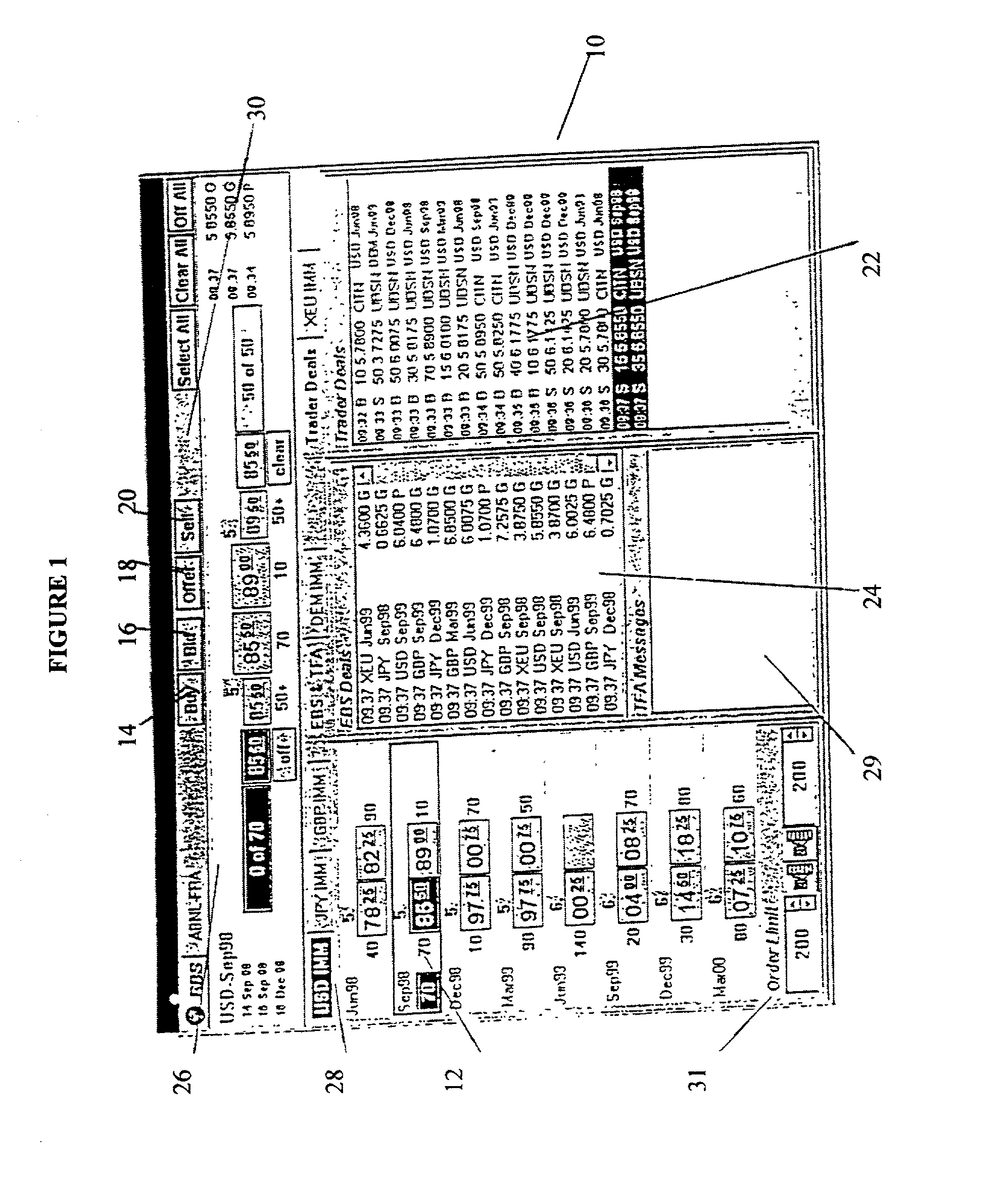

User interface for an electronic trading system

InactiveUS7212999B2Easy to interpretEasy to seeDrawing from basic elementsFinanceMultiple contextData source

A user interface for an electronic trading exchange is provided which allows a remote trader to view in real time bid orders, offer orders, and trades for an item, and optionally one or more sources of contextual data. Individual traders place orders on remote client terminals, and this information is routed to a transaction server. The transaction server receives order information from the remote terminals, matches a bid for an item to an offer for an item responsive to the bid corresponding with the offer, and communicates outstanding bid and offer information, and additional information (such as trades and contextual data) back to the client terminals. Each client terminal displays all of the outstanding bids and offers for an item, allowing the trader to view trends in orders for an item. A priority view is provided in which orders are displayed as tokens at locations corresponding to the values of the orders. The size of the tokens reflects the quantity of the orders. An alternate view positions order icons at a location which reflects the value and quantity of the order. Additionally, contextual data for the item is also displayed to allow the trader to consider as much information as possible while making transaction decisions. A pit panel view is also provided in which traders connected to the pit are represented by icons, and are displayed corresponding to an activity level of the trader.

Owner:TRADING TECH INT INC +1

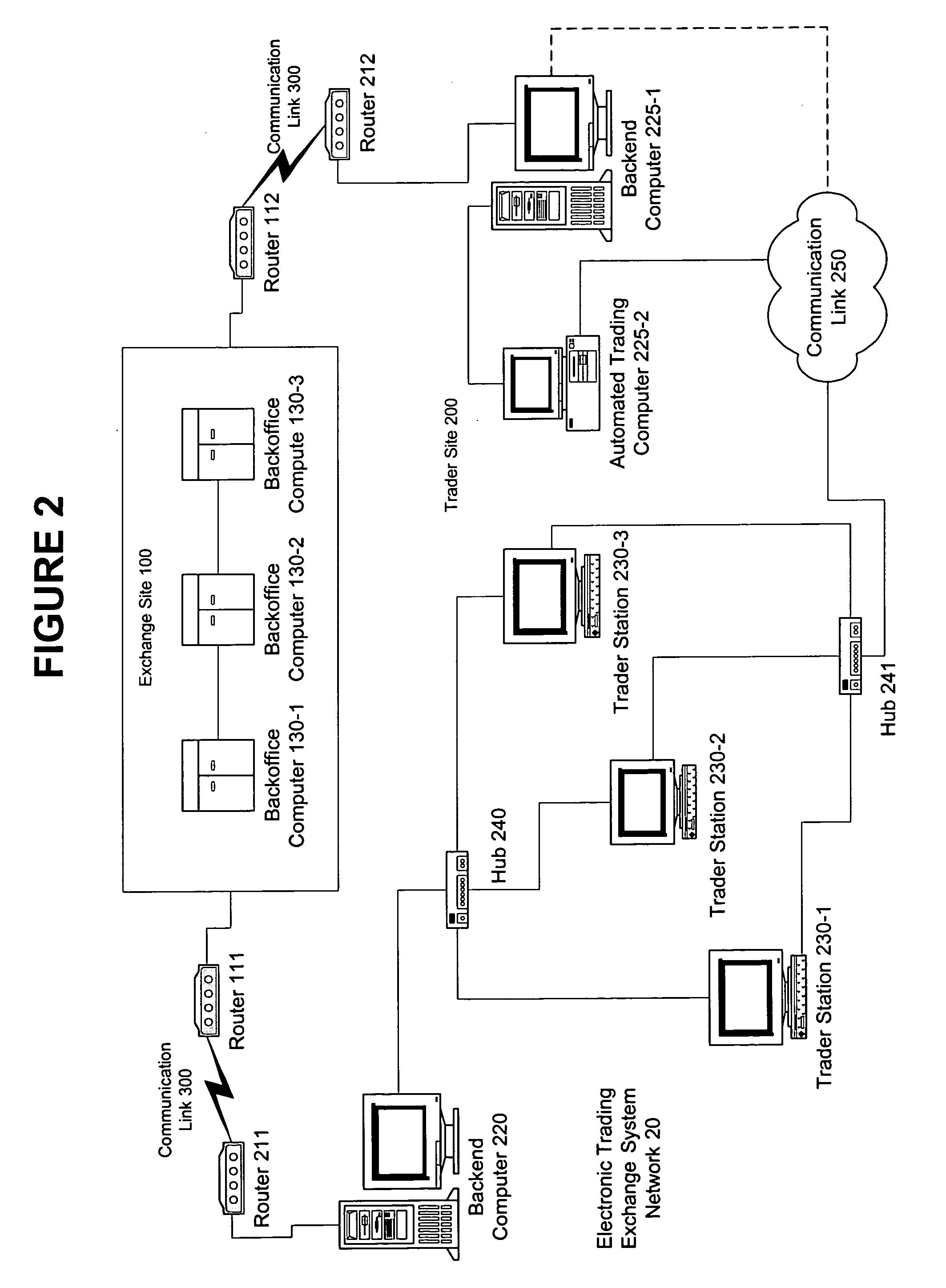

Automated trading system in an electronic trading exchange

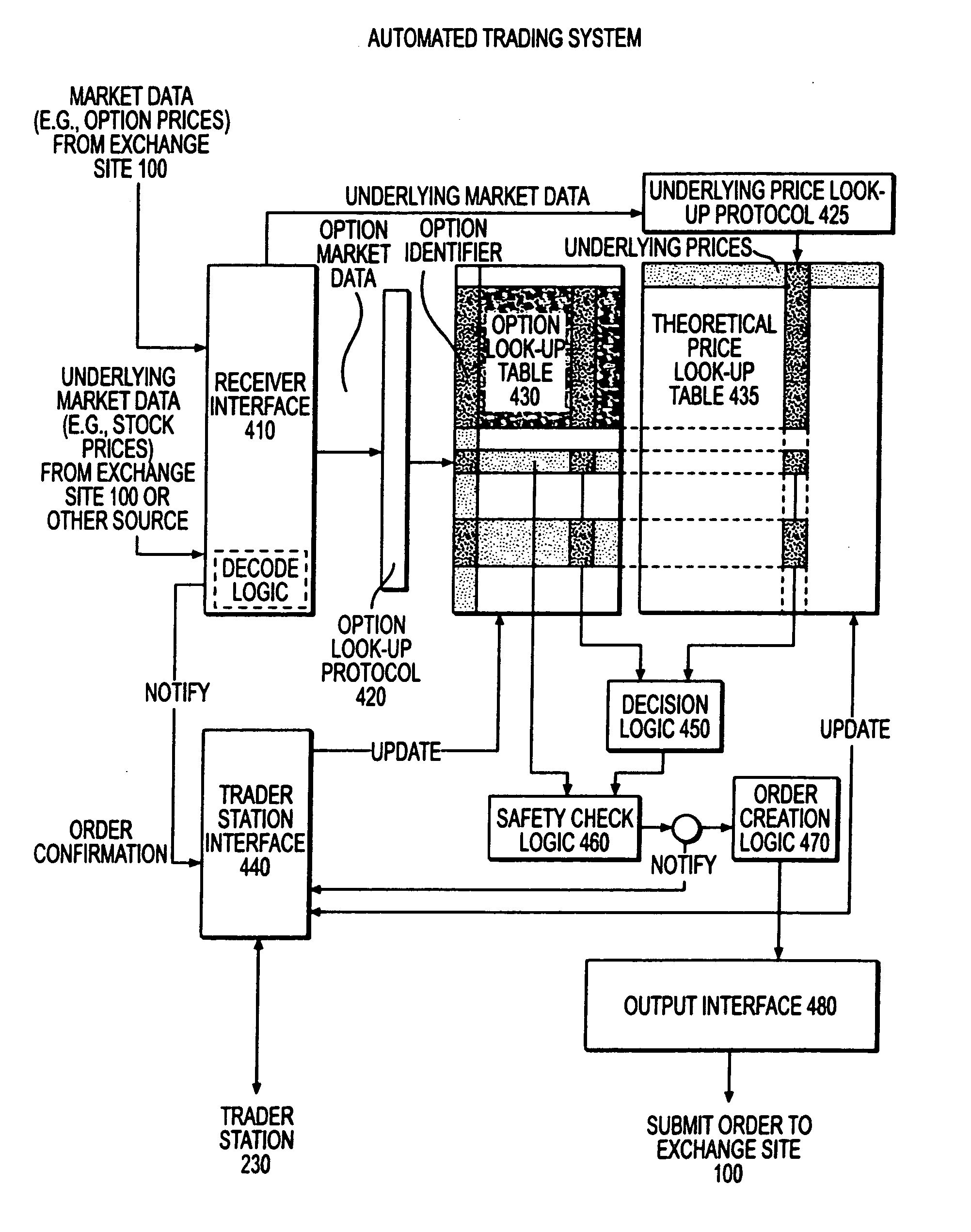

InactiveUS7251629B1Quick responseGuaranteed accuracyComplete banking machinesFinanceData miningElectronic trading

An electronic exchange system network includes a trader site having an automated trading system capable of submitting orders to an exchange site. The automated trading system determines whether an order should be submitted based on, for example, the current market price of an option and theoretical buy and sell prices. The theoretical buy and sell prices are derived from, among other things, the current market price of the security underlying the option. A look-up table stores a range of theoretical buy and sell prices for a given range of current market price of the underlying security. Accordingly, as the price of the underlying security changes, a new theoretical price may be indexed in the look-up table, thereby avoiding calculations that would otherwise slow automated trading decisions. Other techniques may be used in addition or in the alternative to speed automatic decision-making. In addition, a system of checks may be conducted to ensure accurate and safe automated trading. The automated trading system may be capable of automatically submitting orders in connection with the underlying security in order to hedge part of the delta risk associated with the automated option trades.

Owner:DCFB

Methods and apparatus for conducting electronic transactions

InactiveUS20090076966A1Enhanced reliability and confidenceReduce security risksComplete banking machinesAcutation objectsAuthorization certificateChallenge response

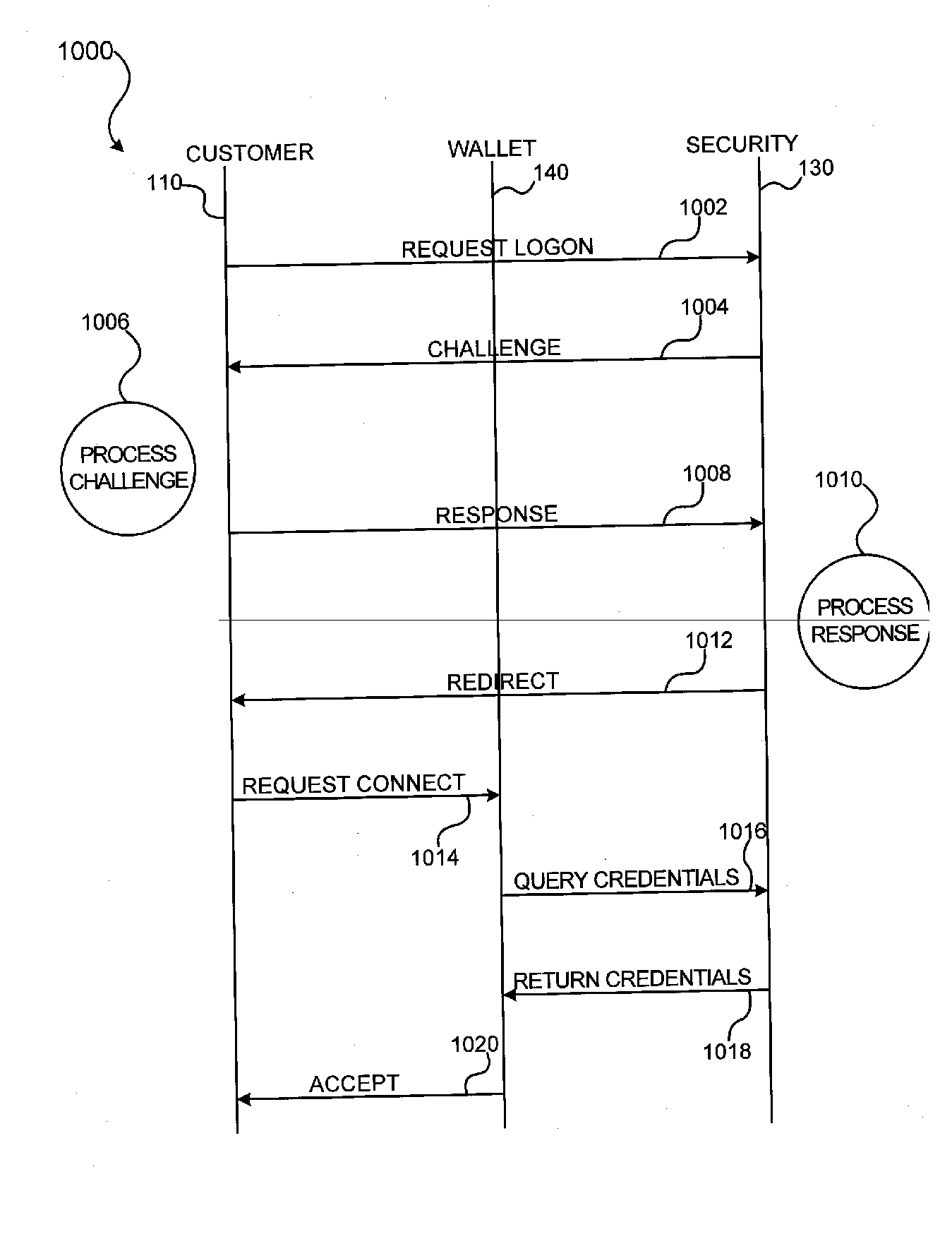

A system and method for facilitating electronic transactions using an intelligent instrument is disclosed. An authorization server enables users to obtain authorization credentials through the use of the intelligent instrument by issuing a challenge to an intelligent token of the intelligent instrument. The intelligent token generates a challenge response and transmits the challenge response to the authorization server, which assembles credentials including a key for the electronic transaction upon validating the response. The authorization server sends the assembled credentials to the intelligent instrument and the intelligent instrument transmits the assembled credentials to the authorization server during a subsequent transaction. The authorization server validates the assembled credentials and provides authorization for the transaction in response to the validating the assembled credentials.

Owner:LIBERTY PEAK VENTURES LLC

Methods and apparatus for conducting electronic transactions

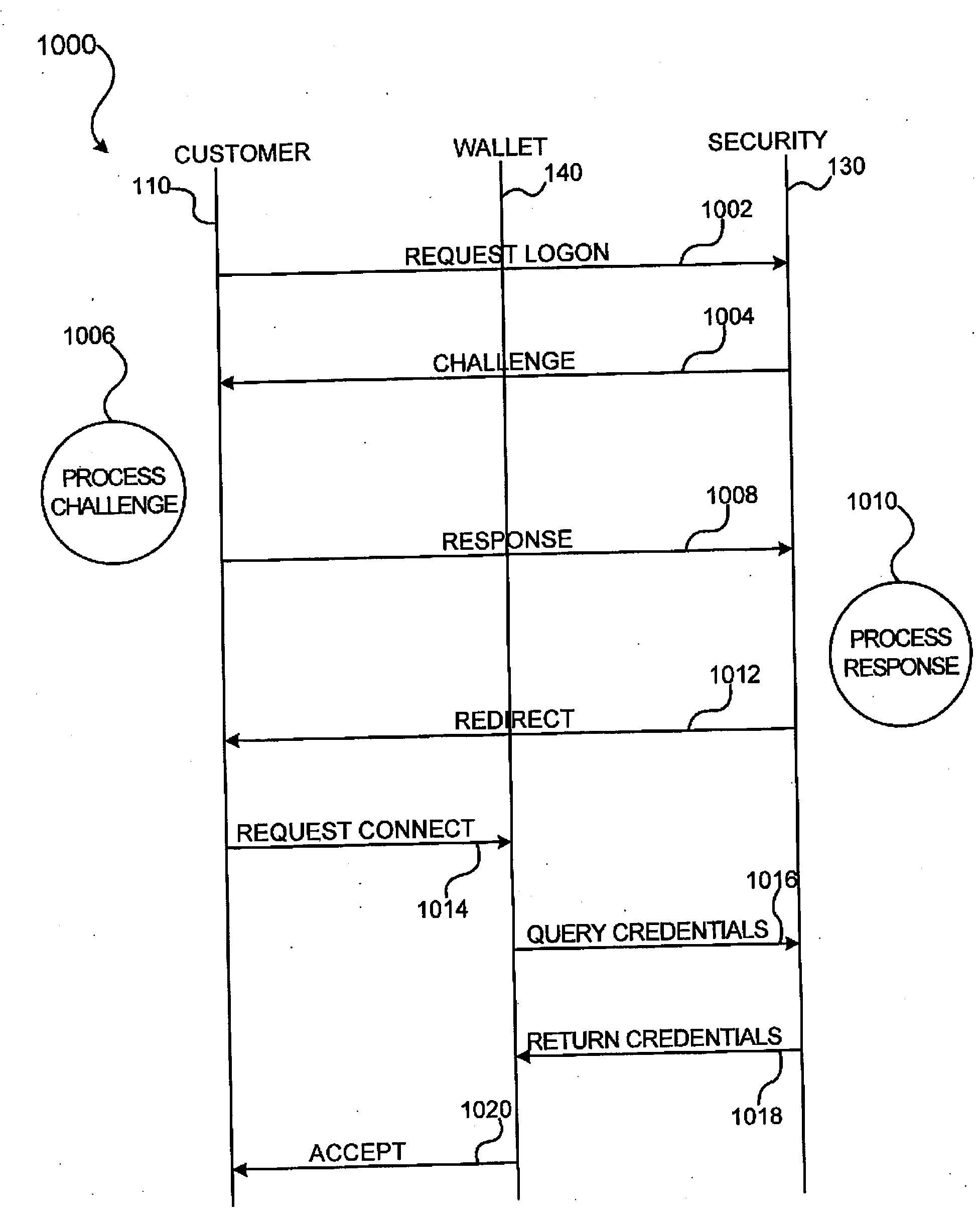

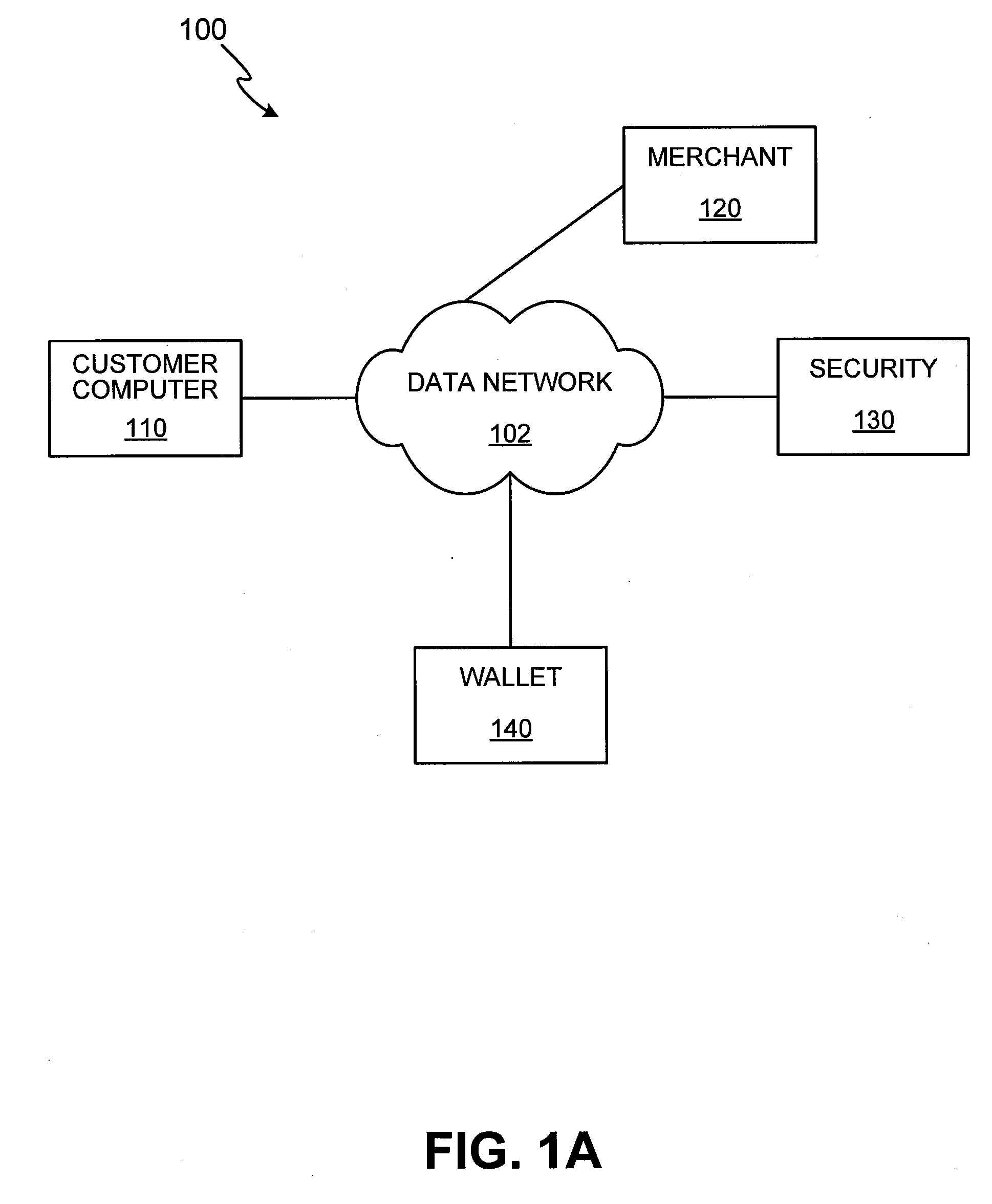

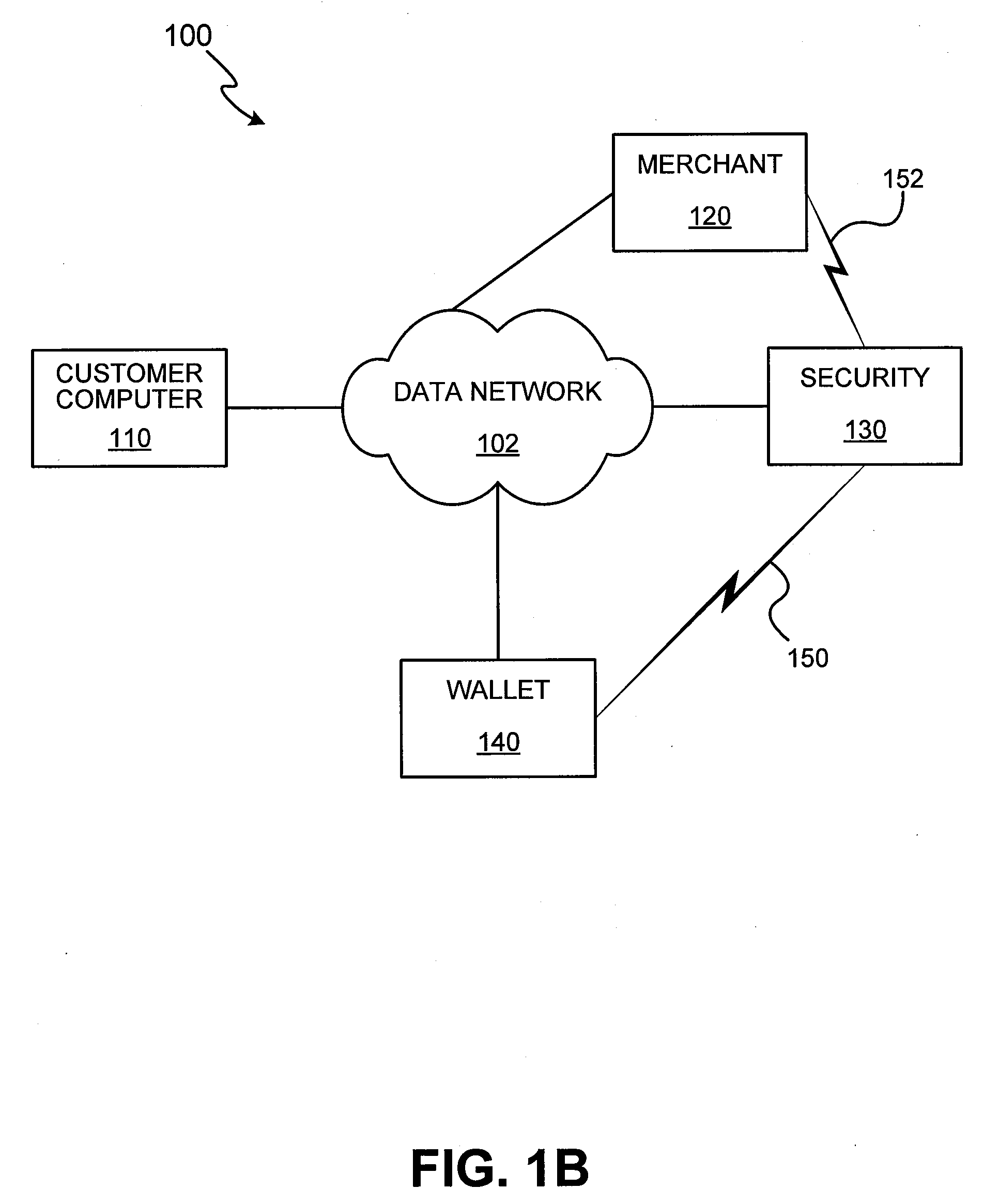

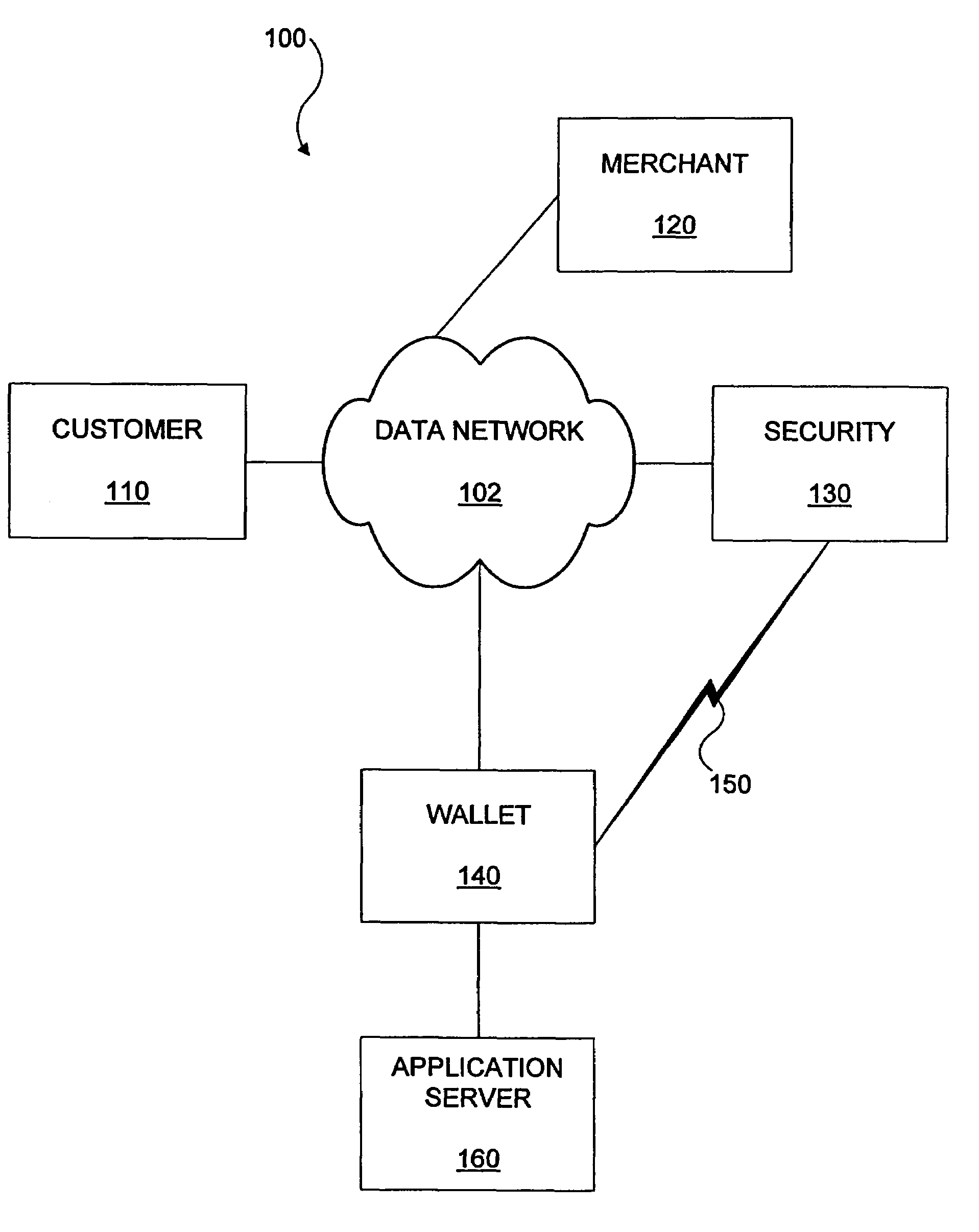

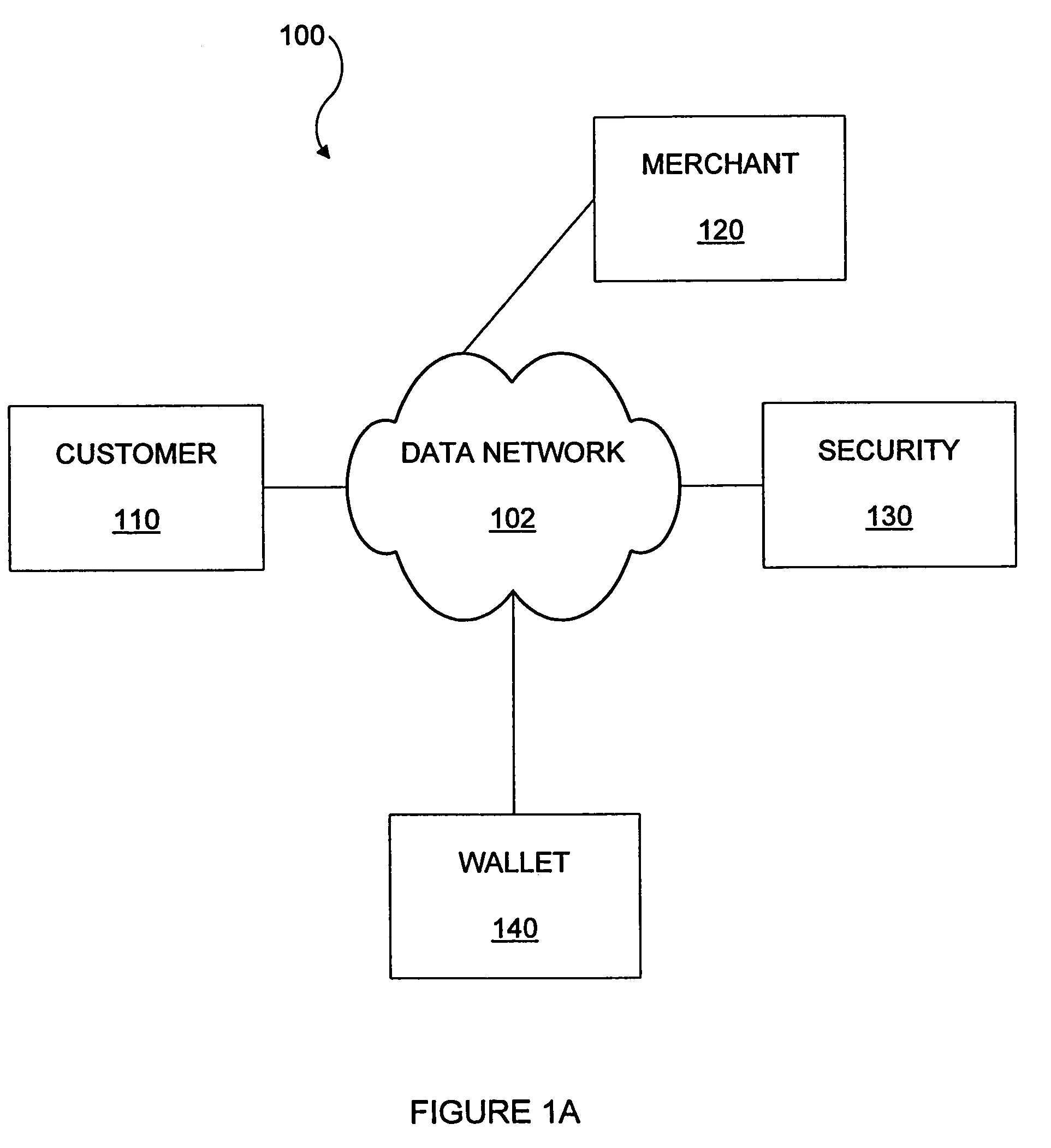

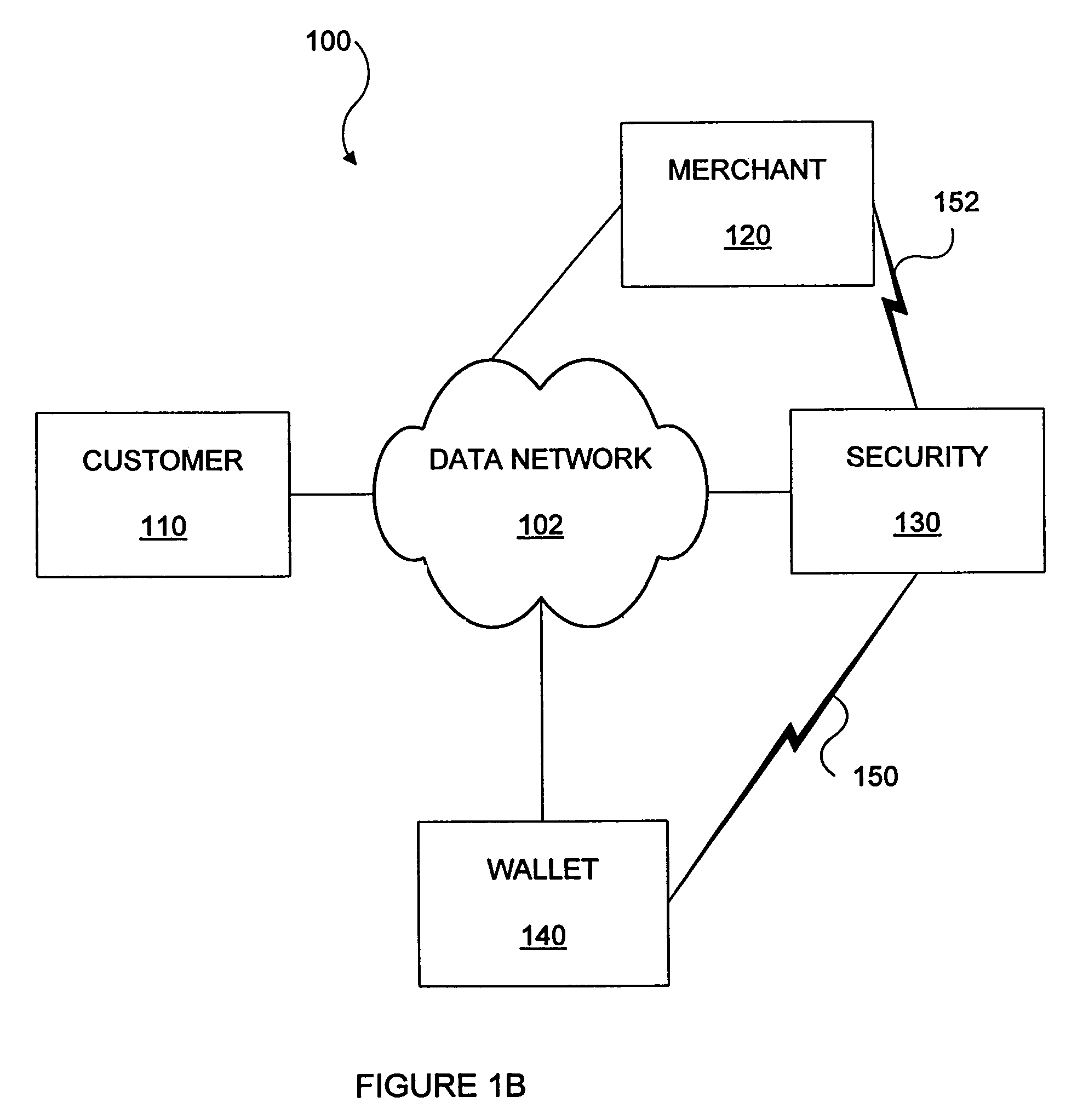

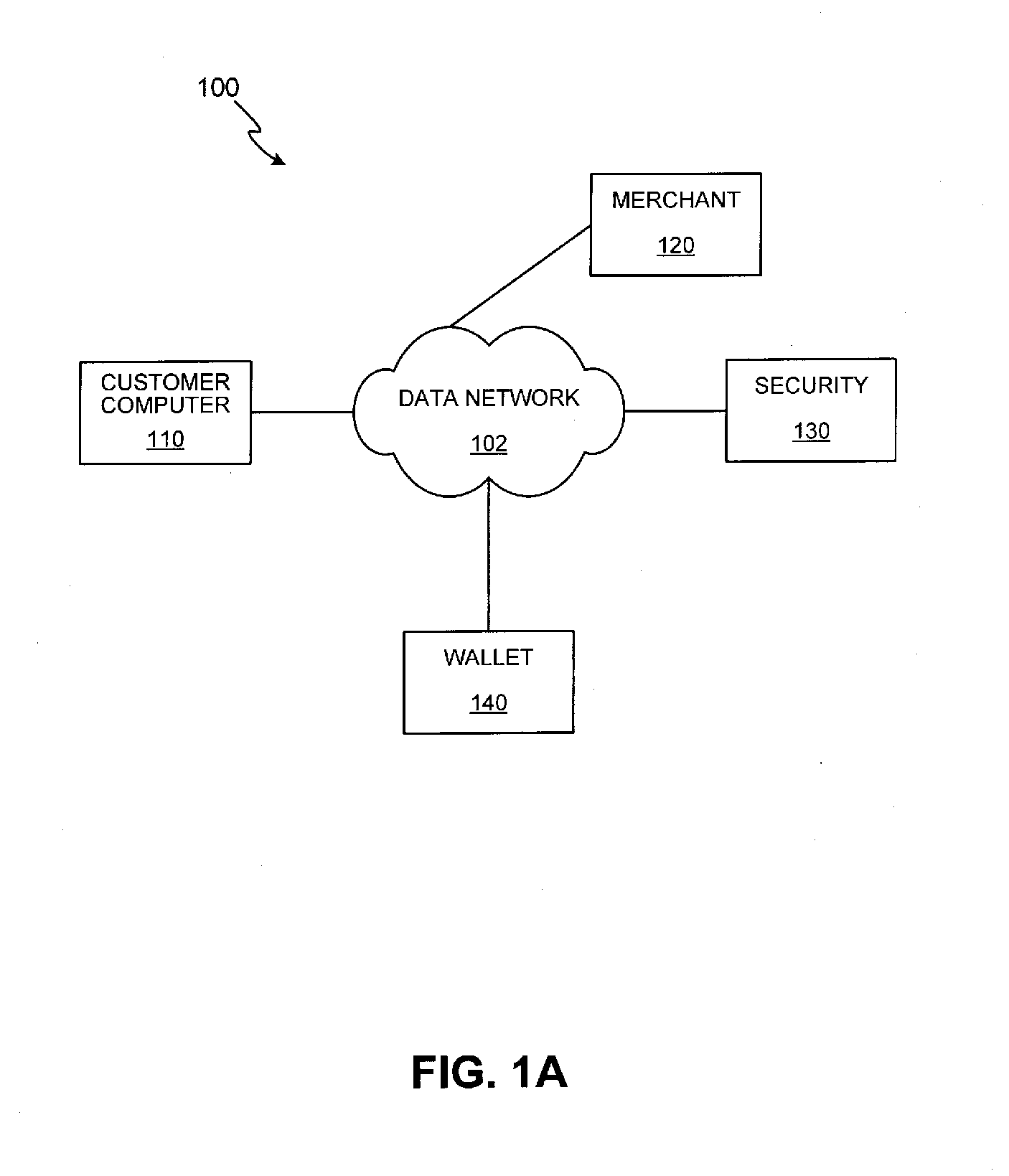

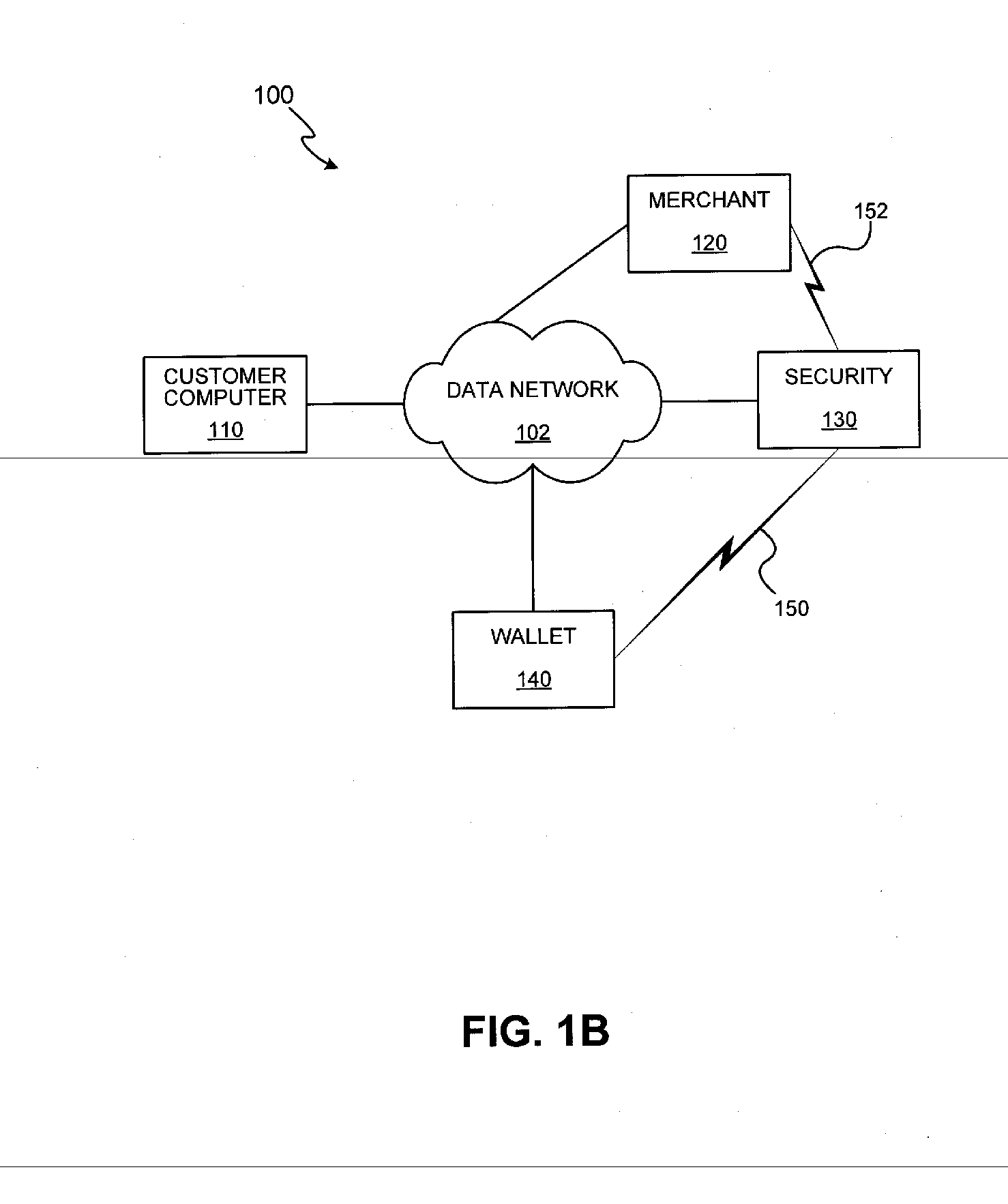

InactiveUS7343351B1Improve reliabilityConfidenceDigital data processing detailsAnalogue secracy/subscription systemsSmart cardE-commerce

A system and method for conducting electronic commerce are disclosed. In various embodiments, the electronic transaction is a purchase transaction. A user is provided with an intelligent token, such as a smartcard containing a digital certificate. The intelligent token suitably authenticates with a server on a network that conducts all or portions of the transaction on behalf of the user. In various embodiments a wallet server interacts with a security server to provide enhanced reliability and confidence in the transaction. In various embodiments, the wallet server includes a toolbar. In various embodiments, the digital wallet pre-fills forms. Forms may be pre-filled using an auto-remember component.

Owner:LIBERTY PEAK VENTURES LLC

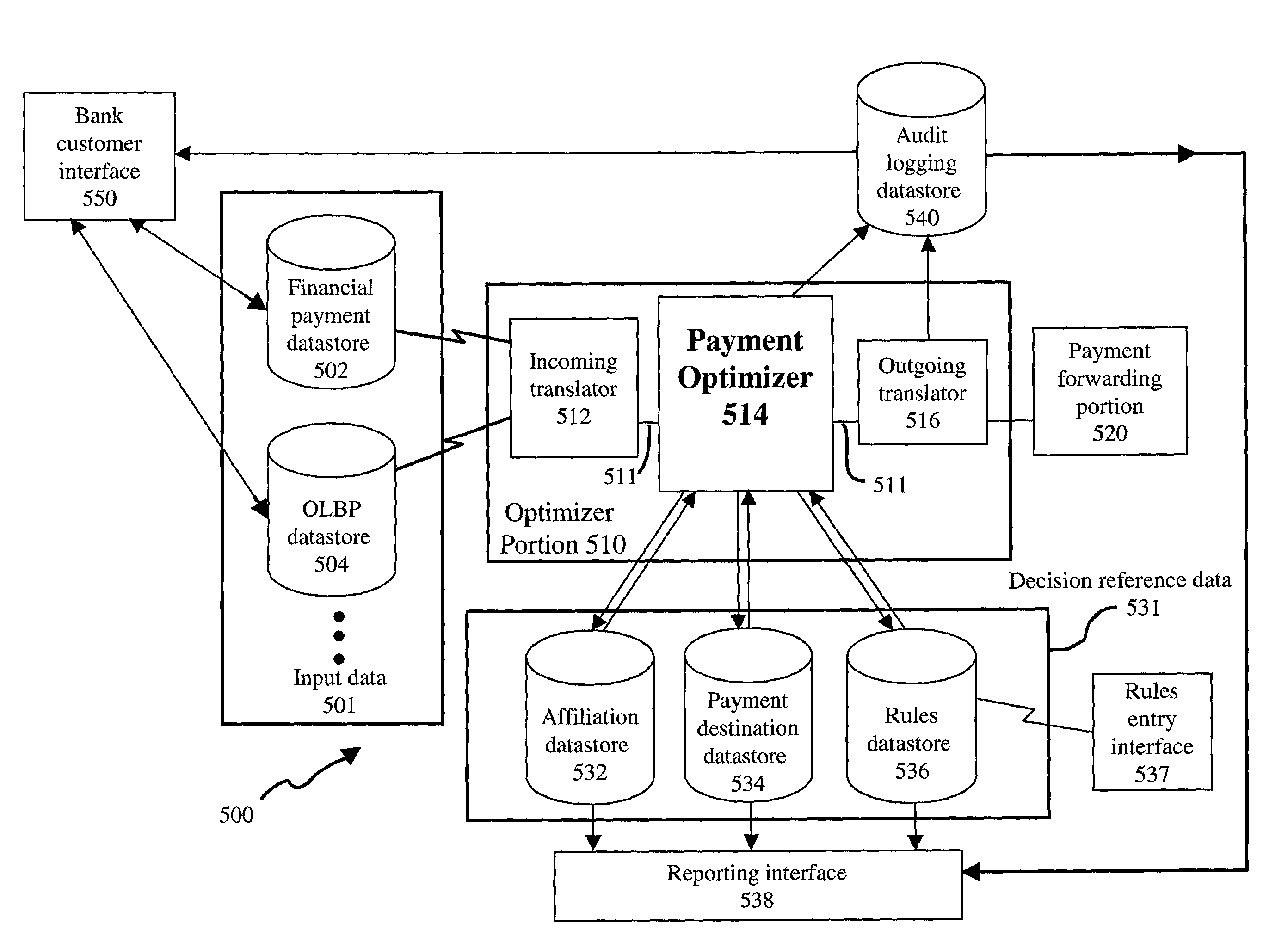

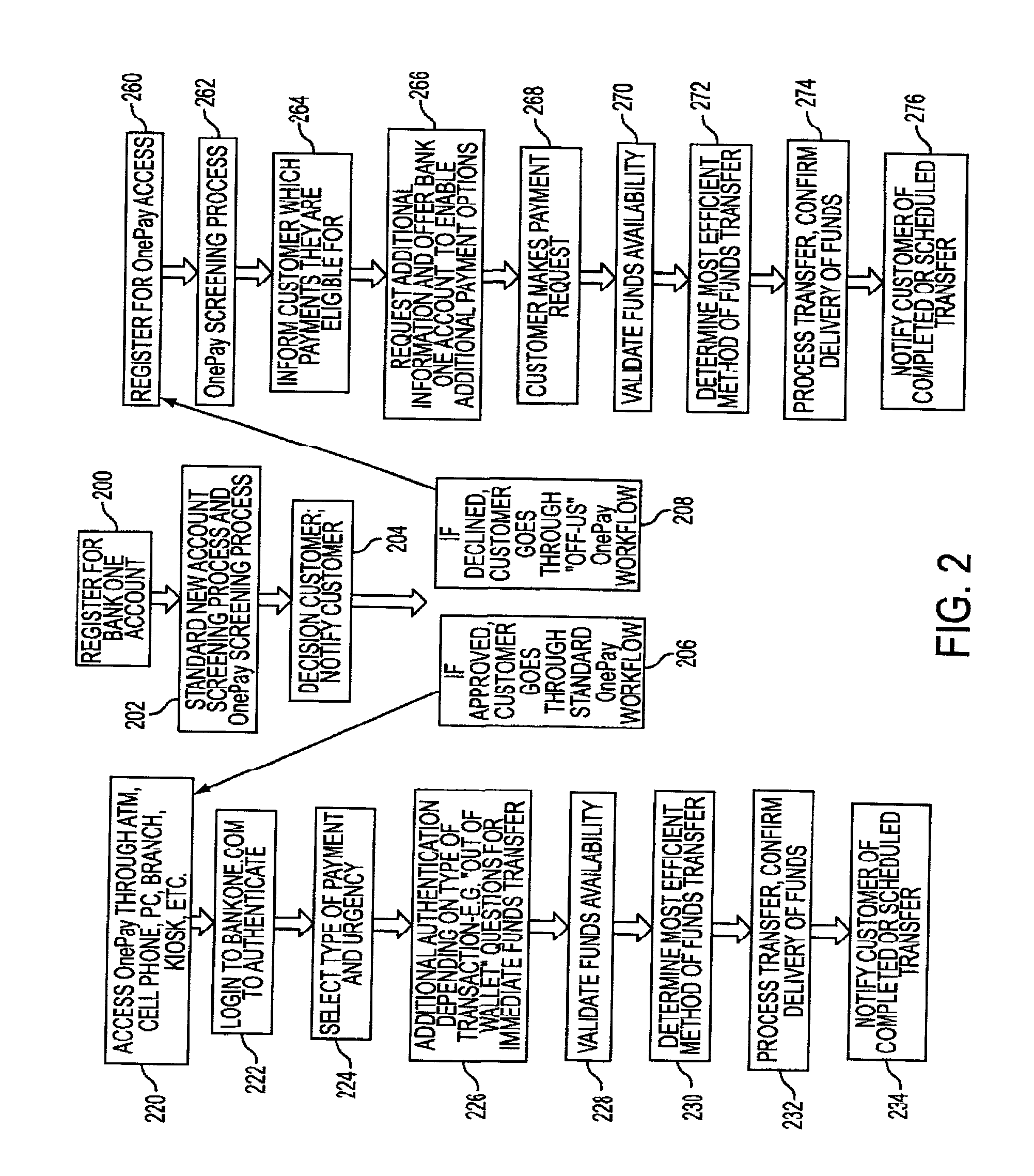

System and method for optimized funding of electronic transactions

The invention provides systems and methods for managing transactions. The system includes a data input portion that communicates first information regarding a payment request, as well as a decision reference data store for communicating second information regarding parameters for use in determining a payment option for the payment request. The system also includes a processor. The processor inputs the first information and the second information. Then, the processor selectably determines the payment option to direct a transmission of funds from at least one payment source to at least one payee account based on an optimization determination performed by the processor. The optimization determination may provide savings to the institution processing the transaction, or alternatively, may provide savings to the customer initiating the transaction, for example.

Owner:JPMORGAN CHASE BANK NA

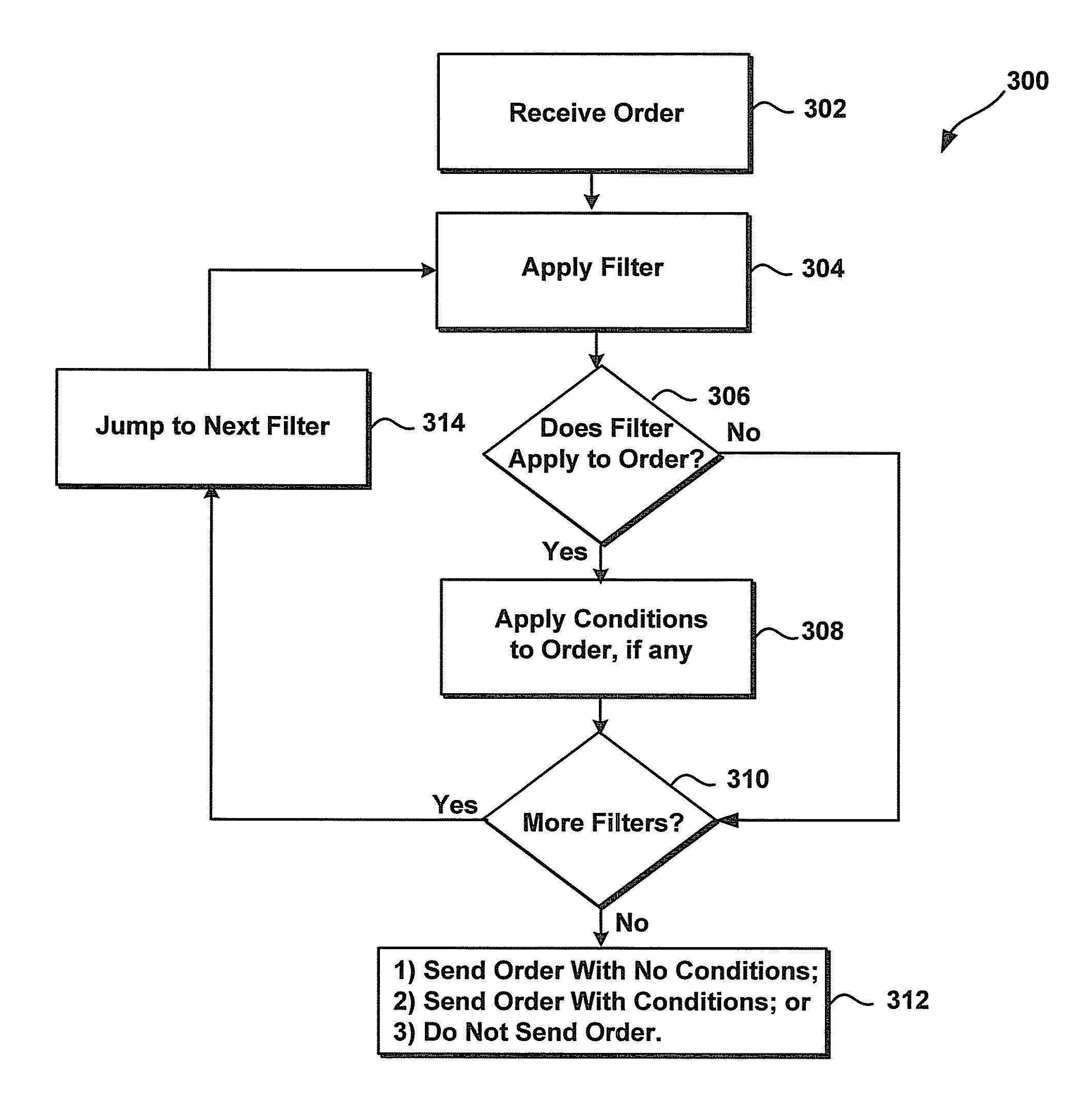

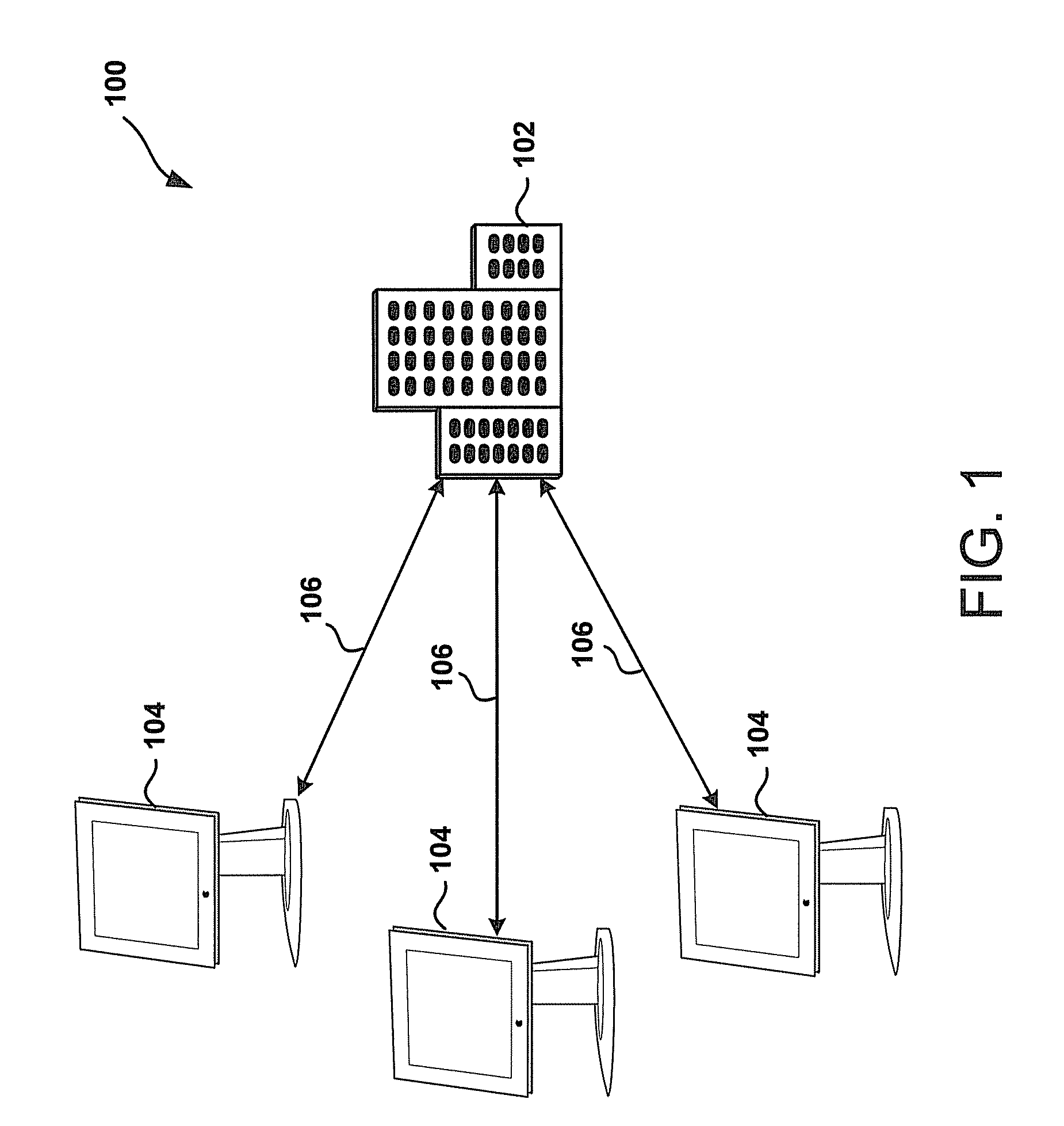

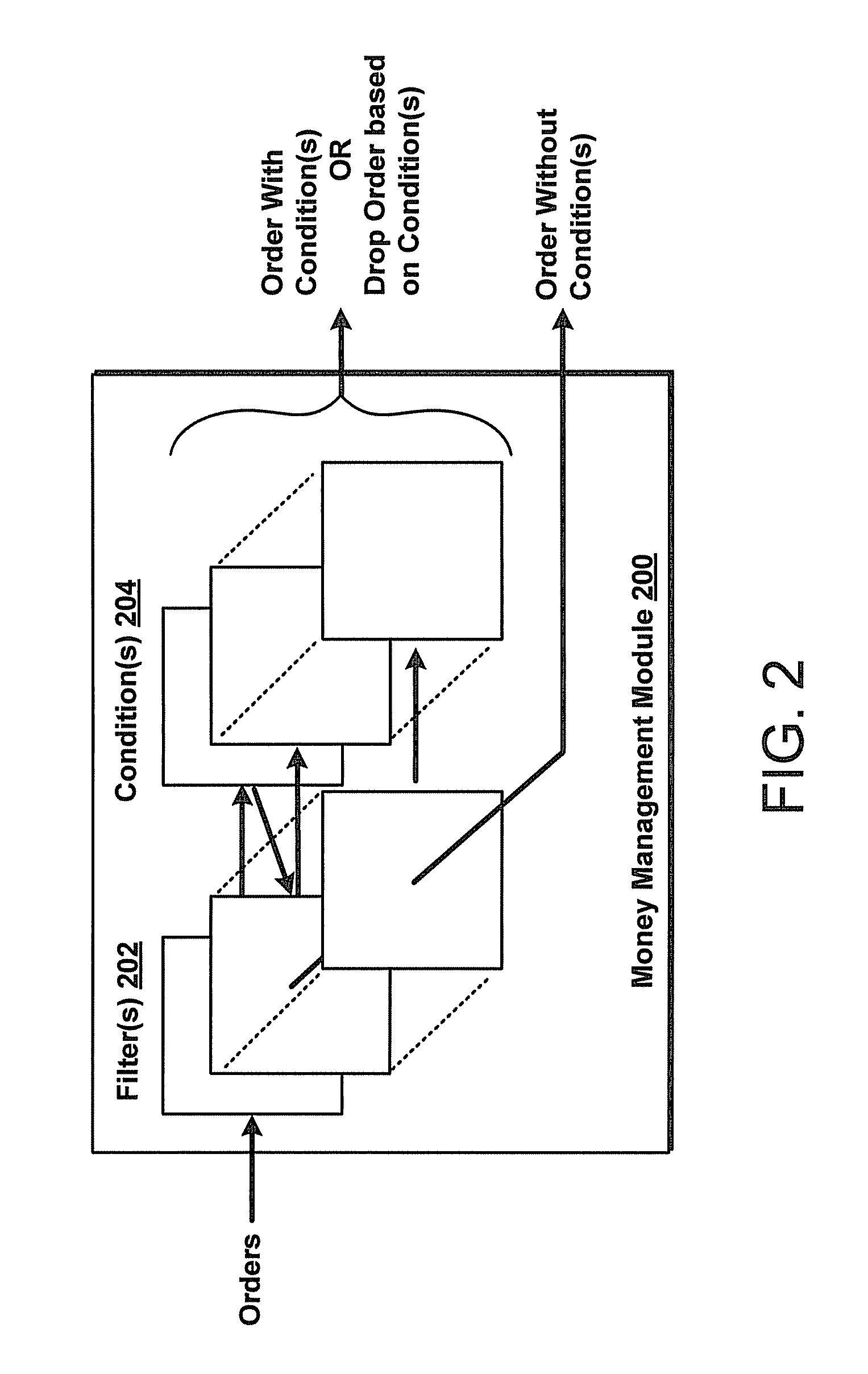

System and method for money management in electronic trading environment

A system and method for money management in an electronic trading environment are presented. According to one embodiment, a trader may configure a plurality of filters, each including at least one filter criteria and filter condition. When a money management module detects a new order, the money management module intercepts the order and determines if the order matches one or more predefined filters. If the order matches one or more filters then conditions associated with the applicable filter(s) are applied to the order. The application of one or more conditions to an order may result in sending a modified order, preventing the order from reaching the exchange, or sending order to the exchange without any modifications.

Owner:TRADING TECH INT INC

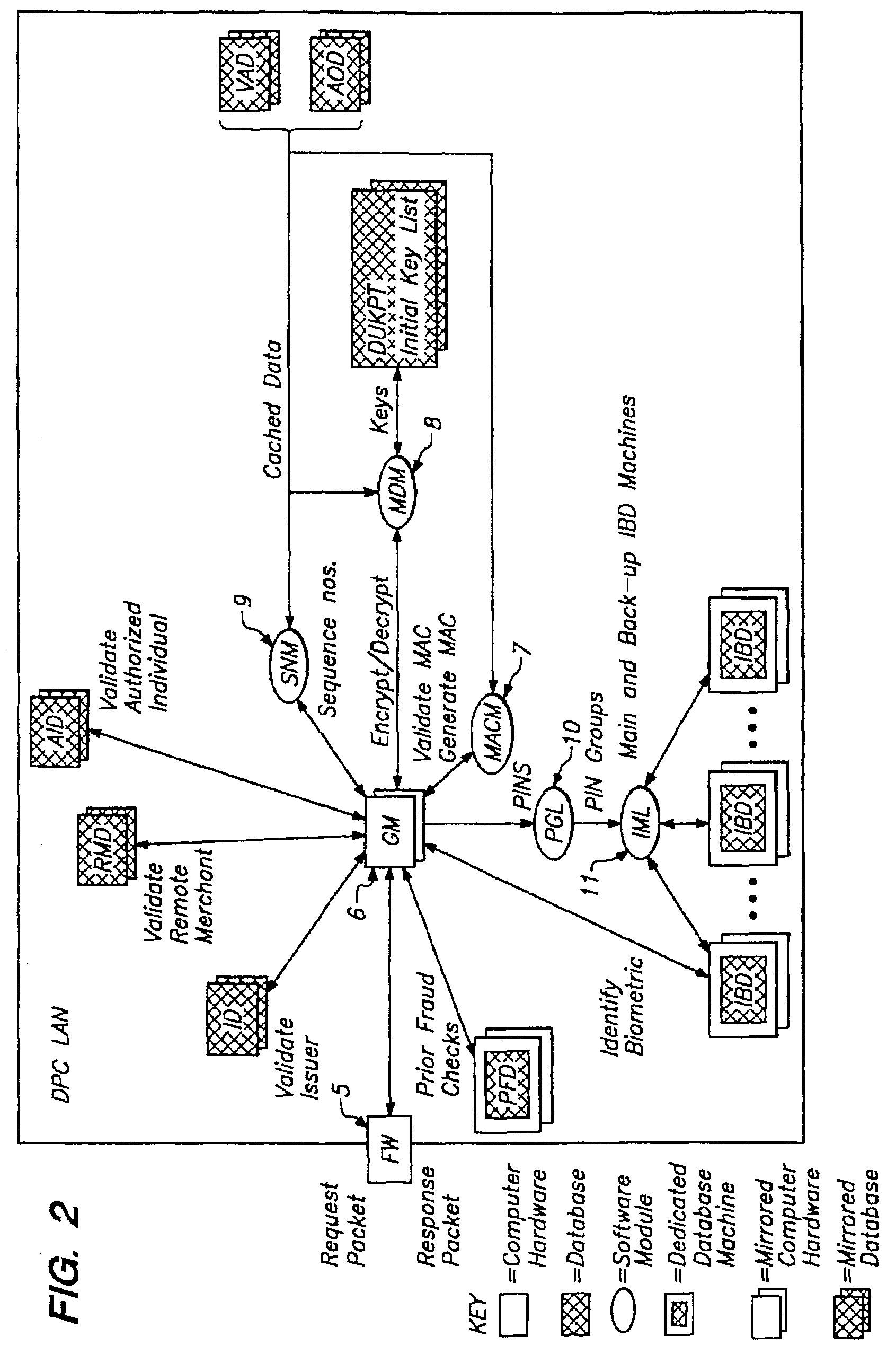

Tokenless identification system for authorization of electronic transactions and electronic transmissions

InactiveUS7152045B2Eliminate riskEnhances fraud resistanceCredit registering devices actuationDigital data processing detailsElectronic transmissionComputerized system

A tokenless identification system and method for authorization of transactions and transmissions. The tokenless system and method are principally based on a correlative comparison of a unique biometrics sample, such as a finger print or voice recording, gathered directly from the person of an unknown user, with an authenticated biometrics sample of the same type obtained and stored previously. It can be networked to act as a full or partial intermediary between other independent computer systems, or may be the sole computer systems carrying out all necessary executions. It further contemplates the use of a private code that is returned to the user after the identification has been complete, authenticating and indicating to the user that the computer system was accessed. The identification system and method of additionally include emergency notification to permit an authorized user to alert authorities an access attempt is coerced.

Owner:EXCEL INNOVATIONS +1

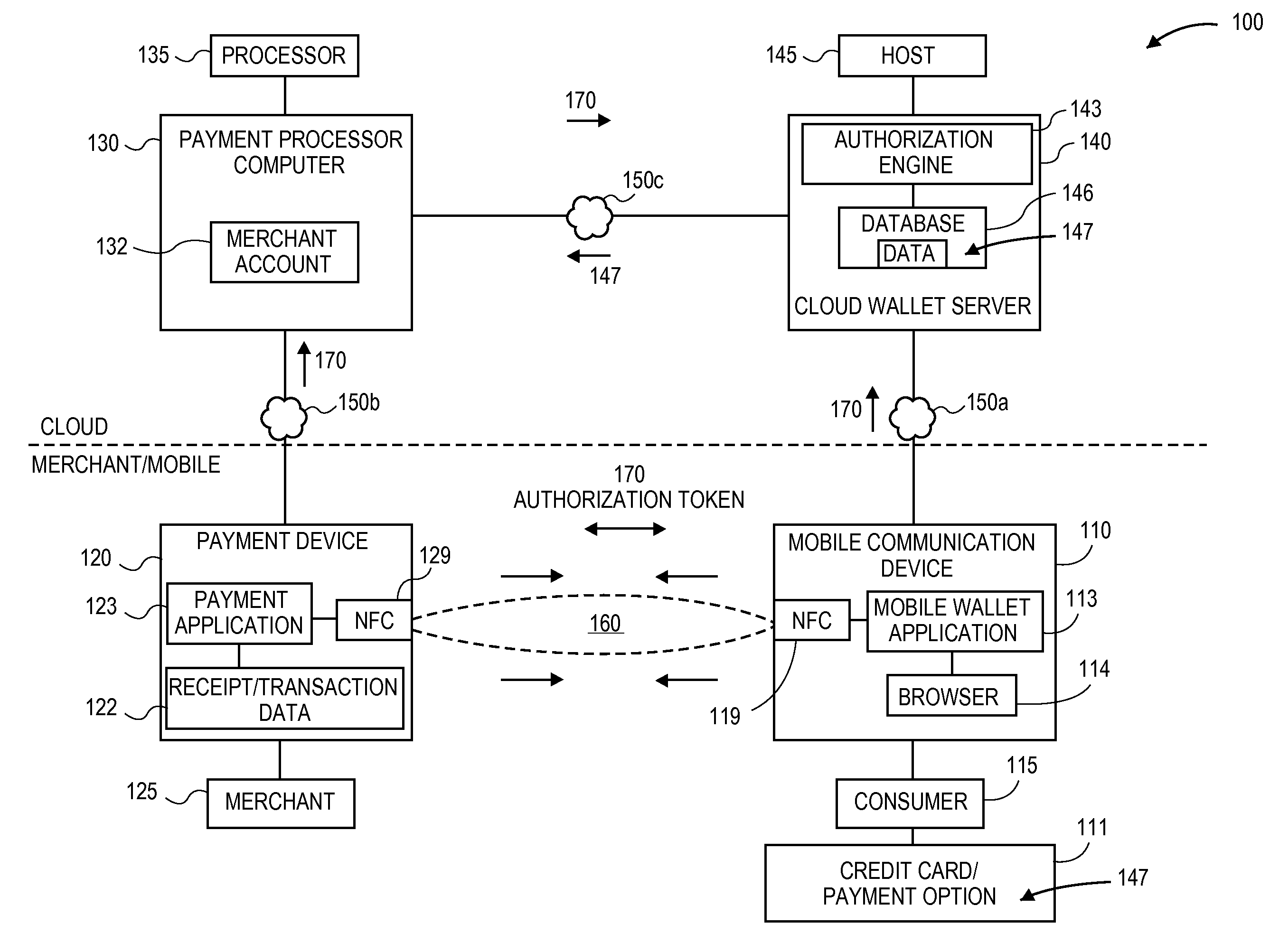

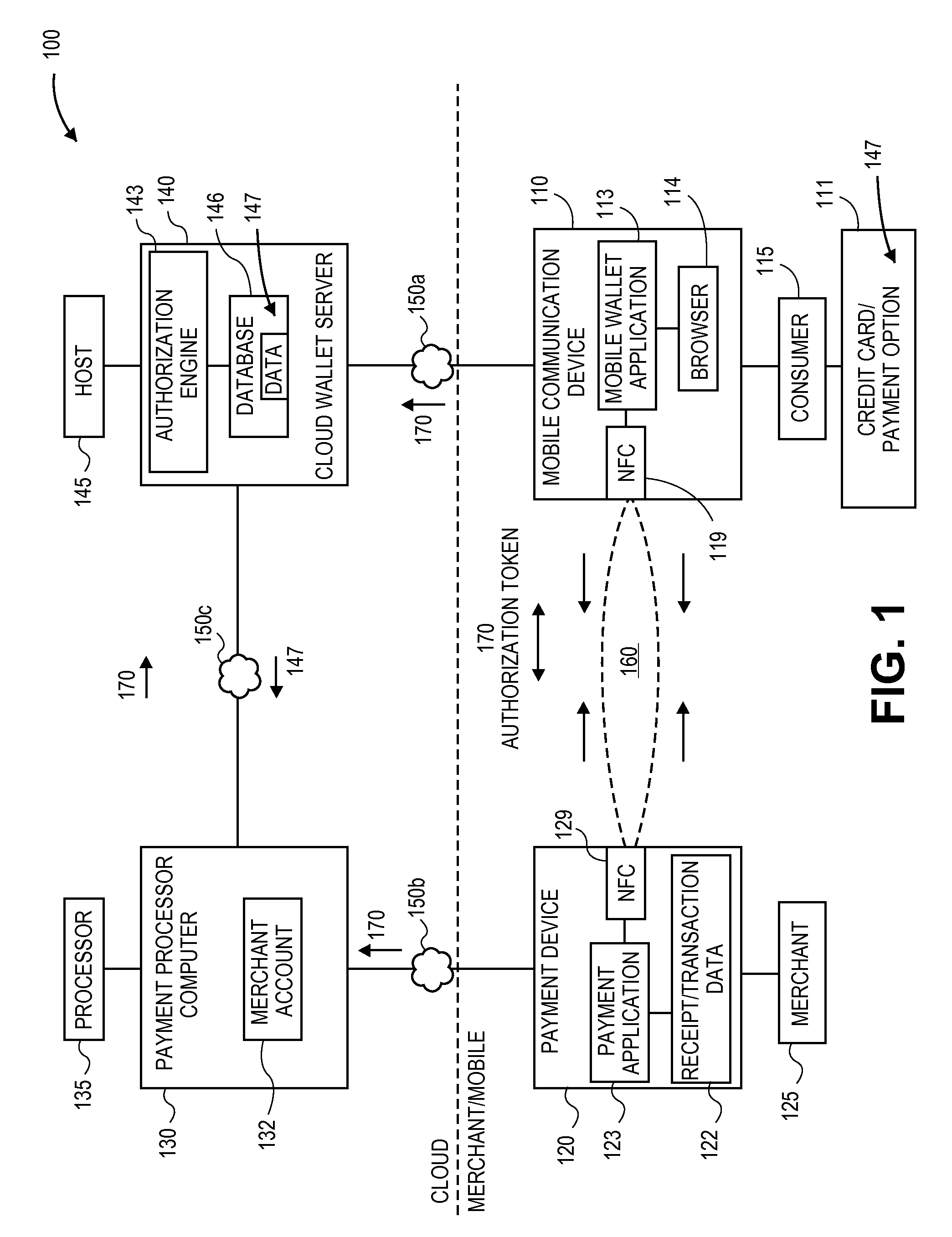

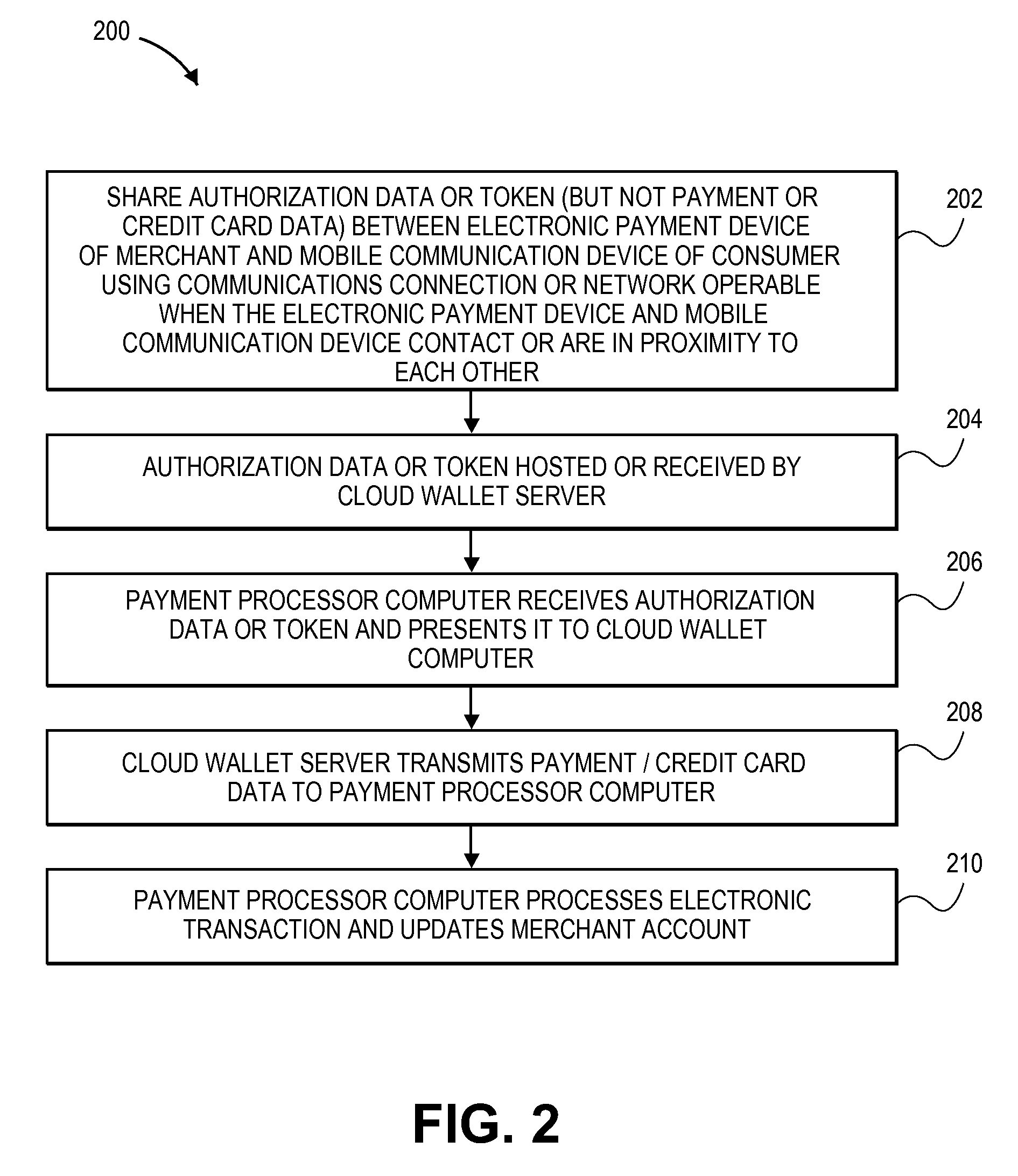

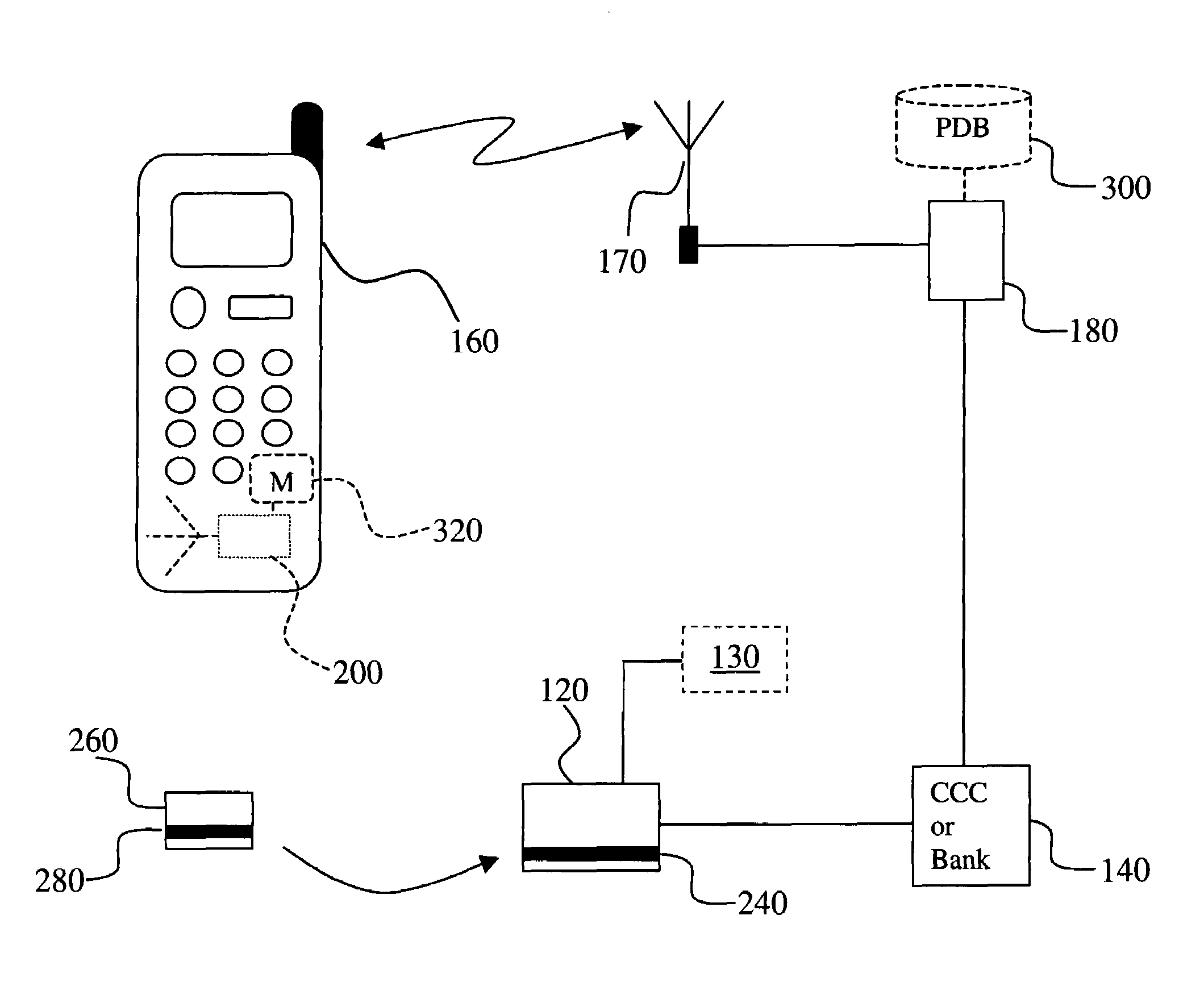

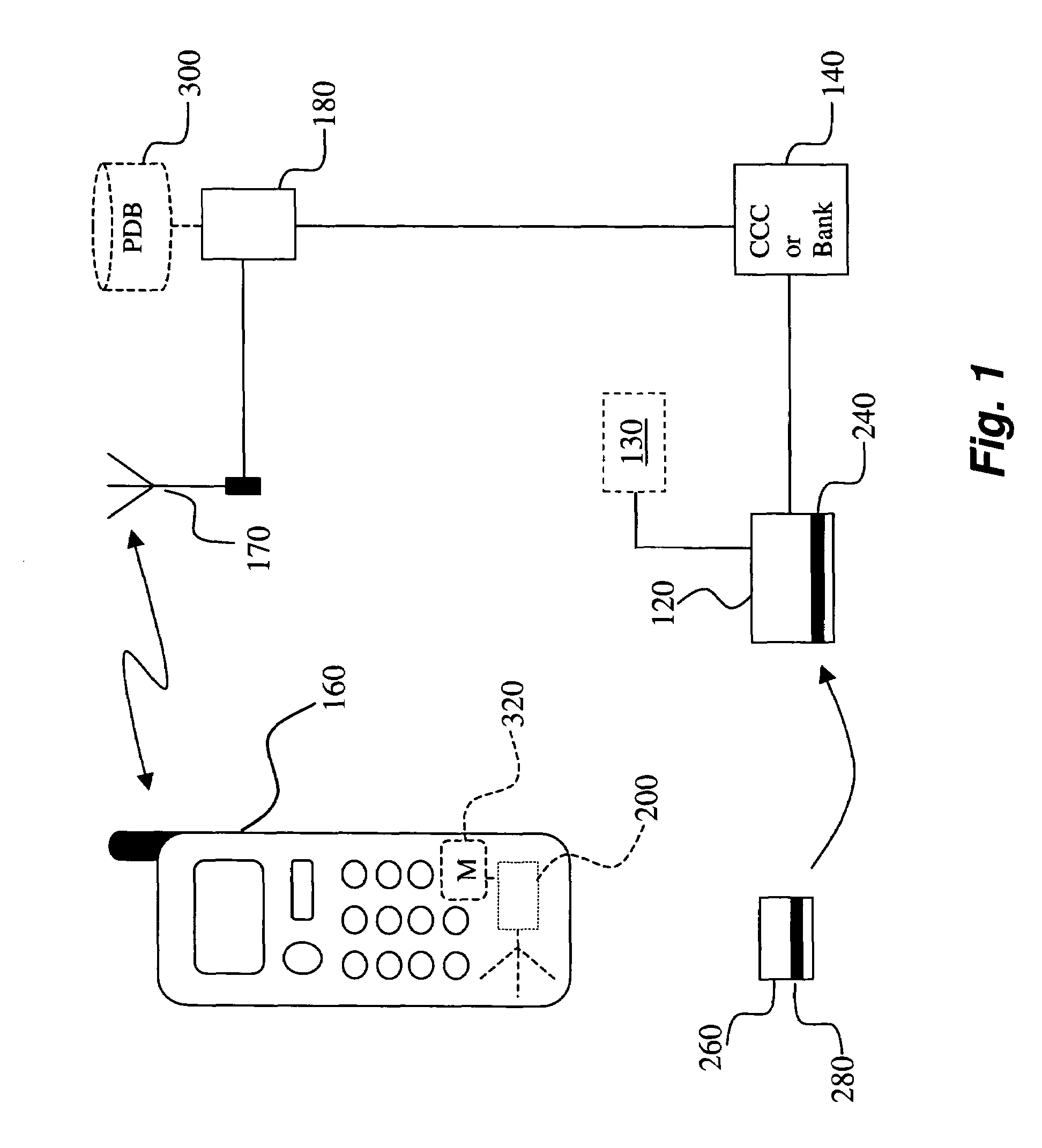

Processing electronic payment involving mobile communication device

ActiveUS20120290376A1The right amountPoint-of-sale network systemsCommerceComputer hardwareCredit card

Mobile payments and processing data related to electronic transactions. A near field communication connection is established between a mobile communication device of a consumer that serves as a mobile wallet and an electronic payment device of a merchant. Authorization data is shared between the mobile communication device and the electronic payment device without providing electronic payment instrument (e.g. credit card) data to the merchant. Authorization data is transmitted from the mobile communication device to a cloud computer or resource that serves as a cloud wallet and hosts respective data of respective electronic payment instruments of respective consumers, and from the electronic payment device a payment processor computer. The payment processor computer presents the authorization data to the cloud wallet, and in response, the cloud wallet transmits the credit card data to the payment processor computer, which processes the transaction.

Owner:INTUIT INC

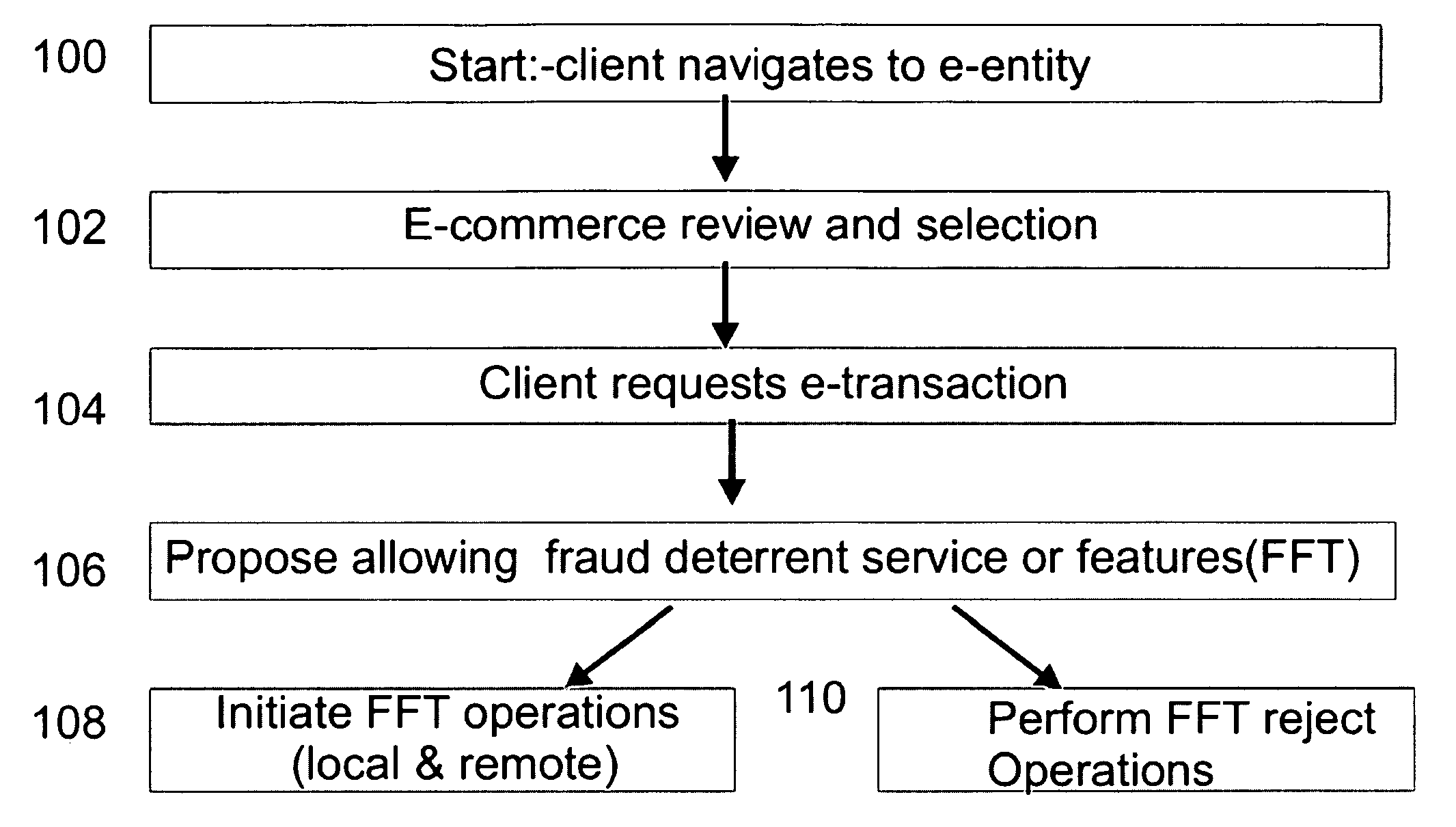

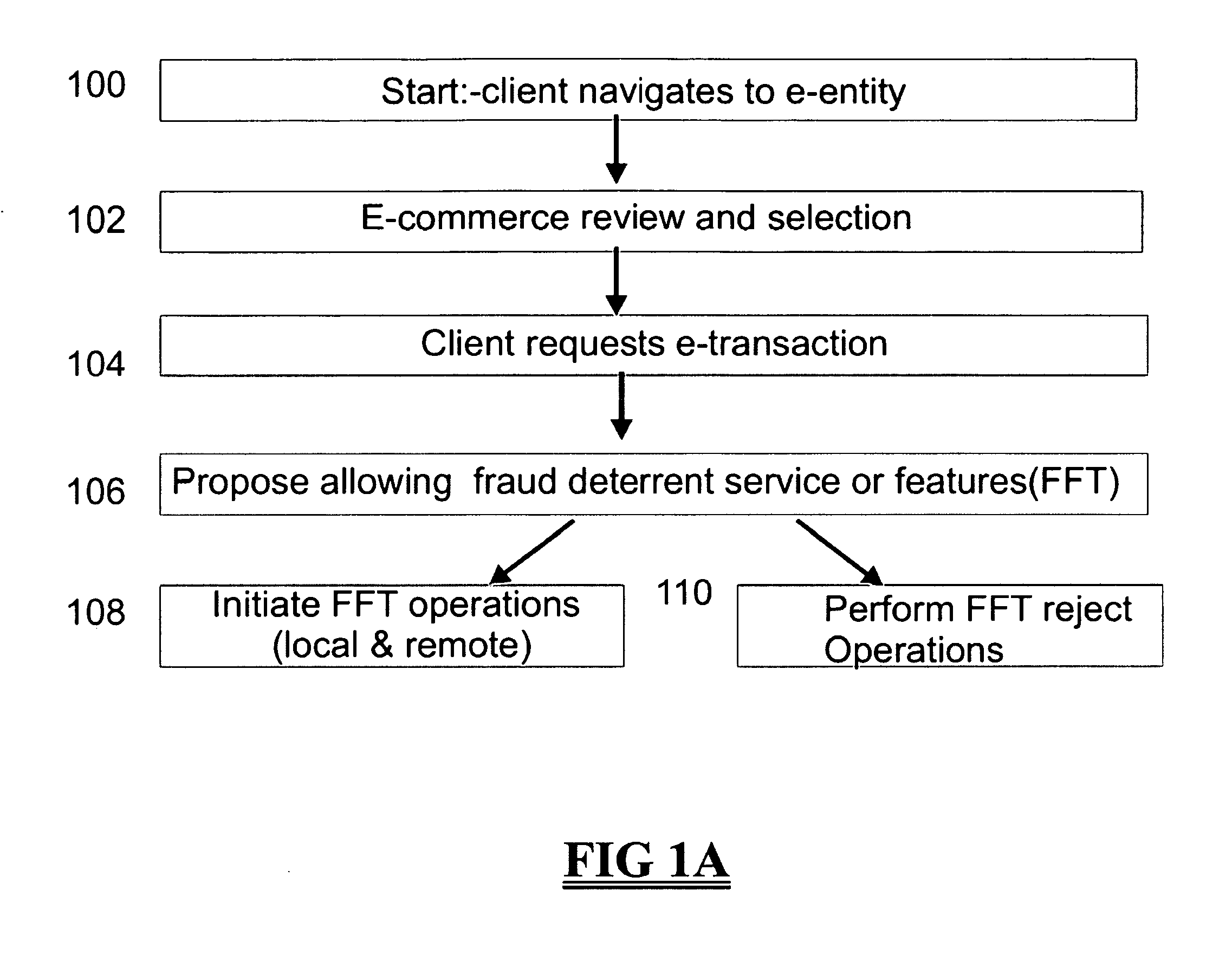

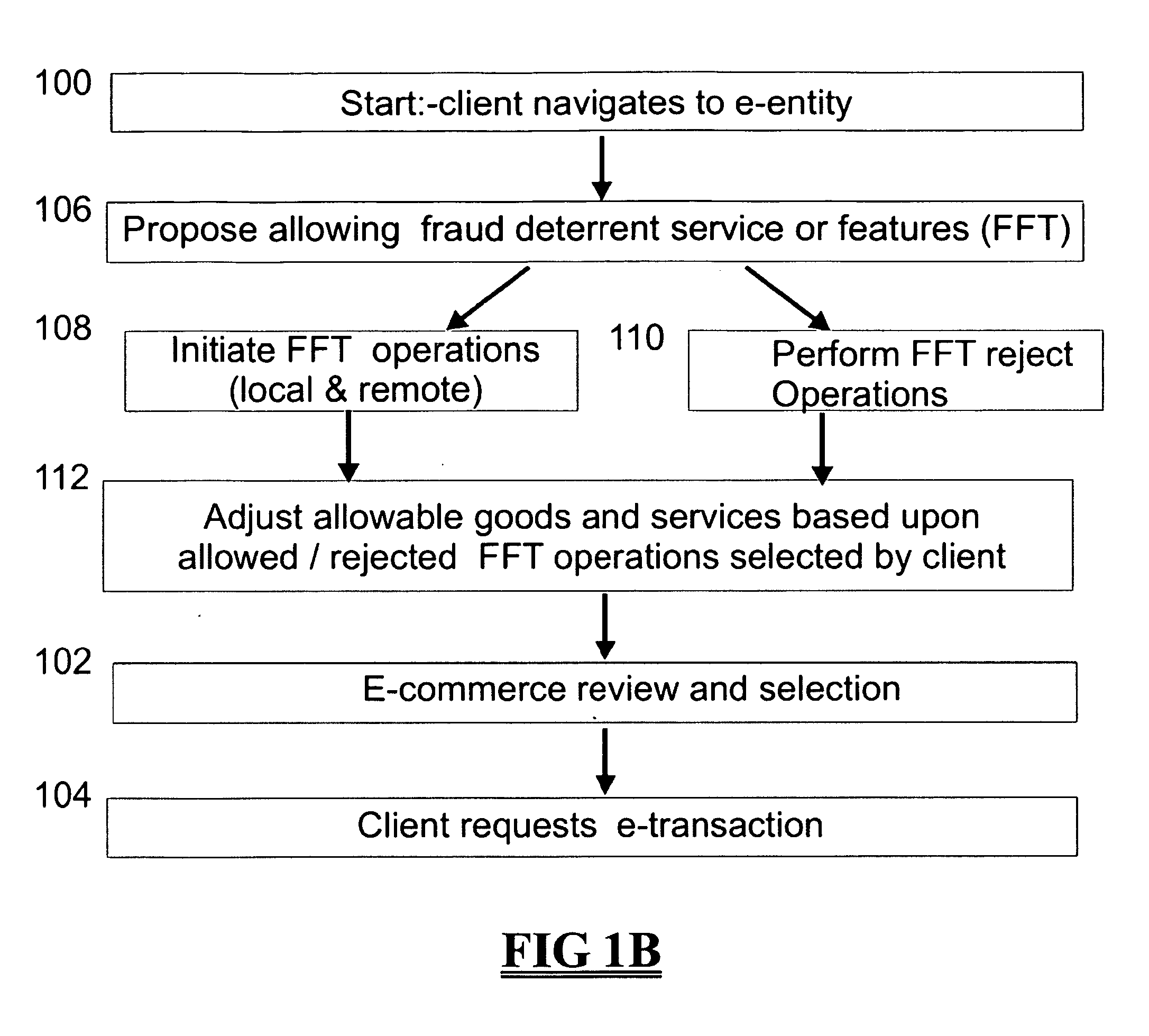

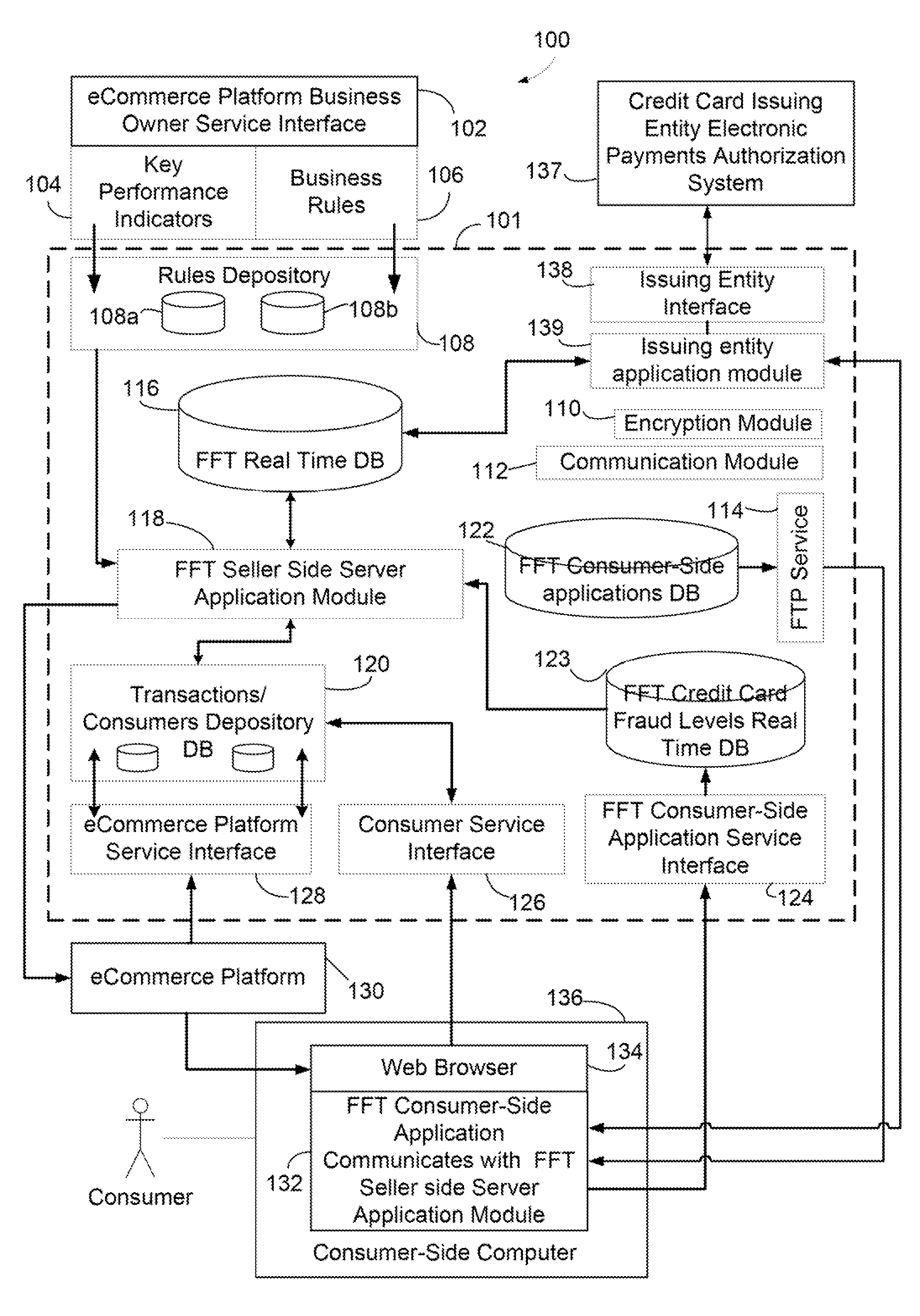

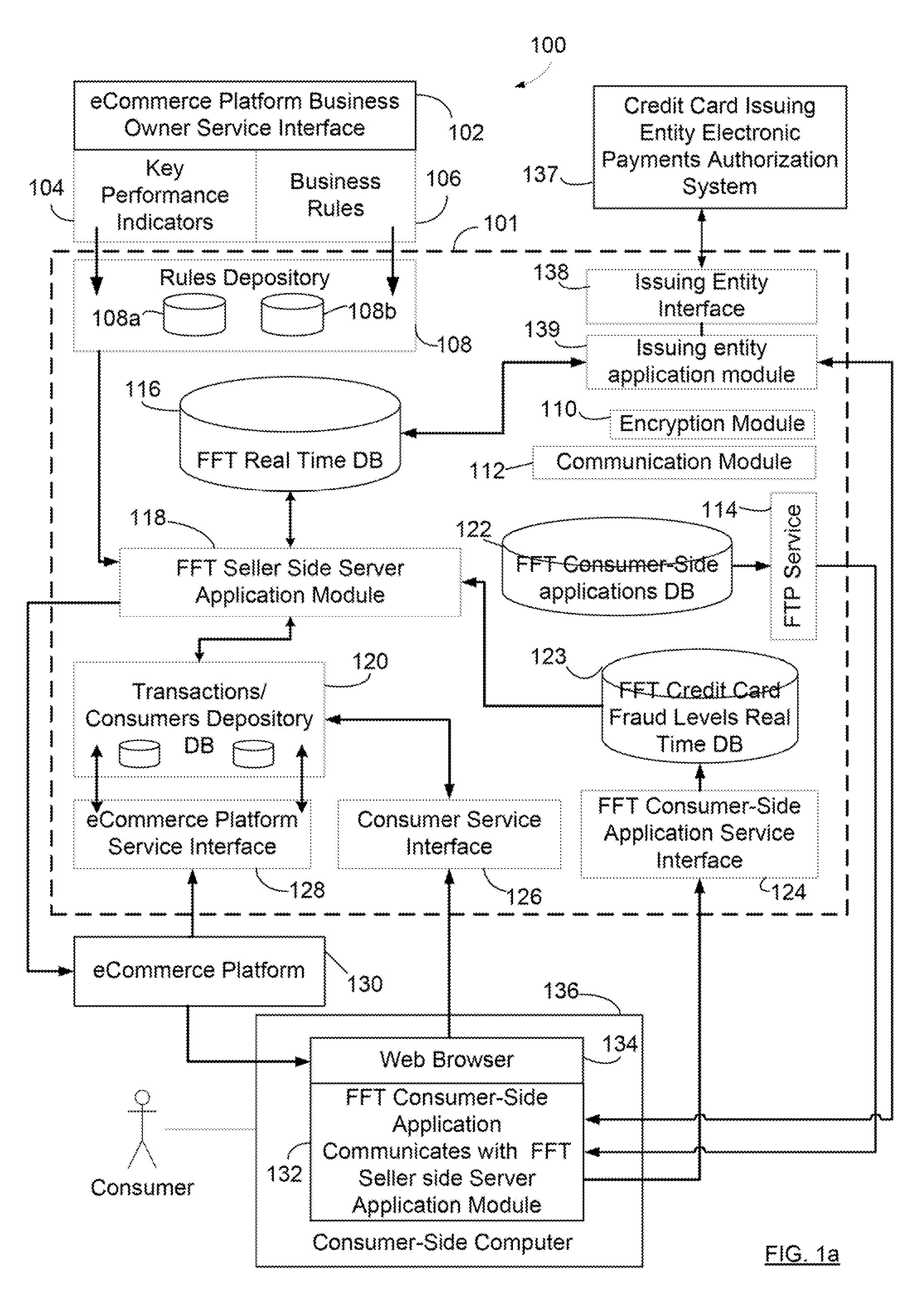

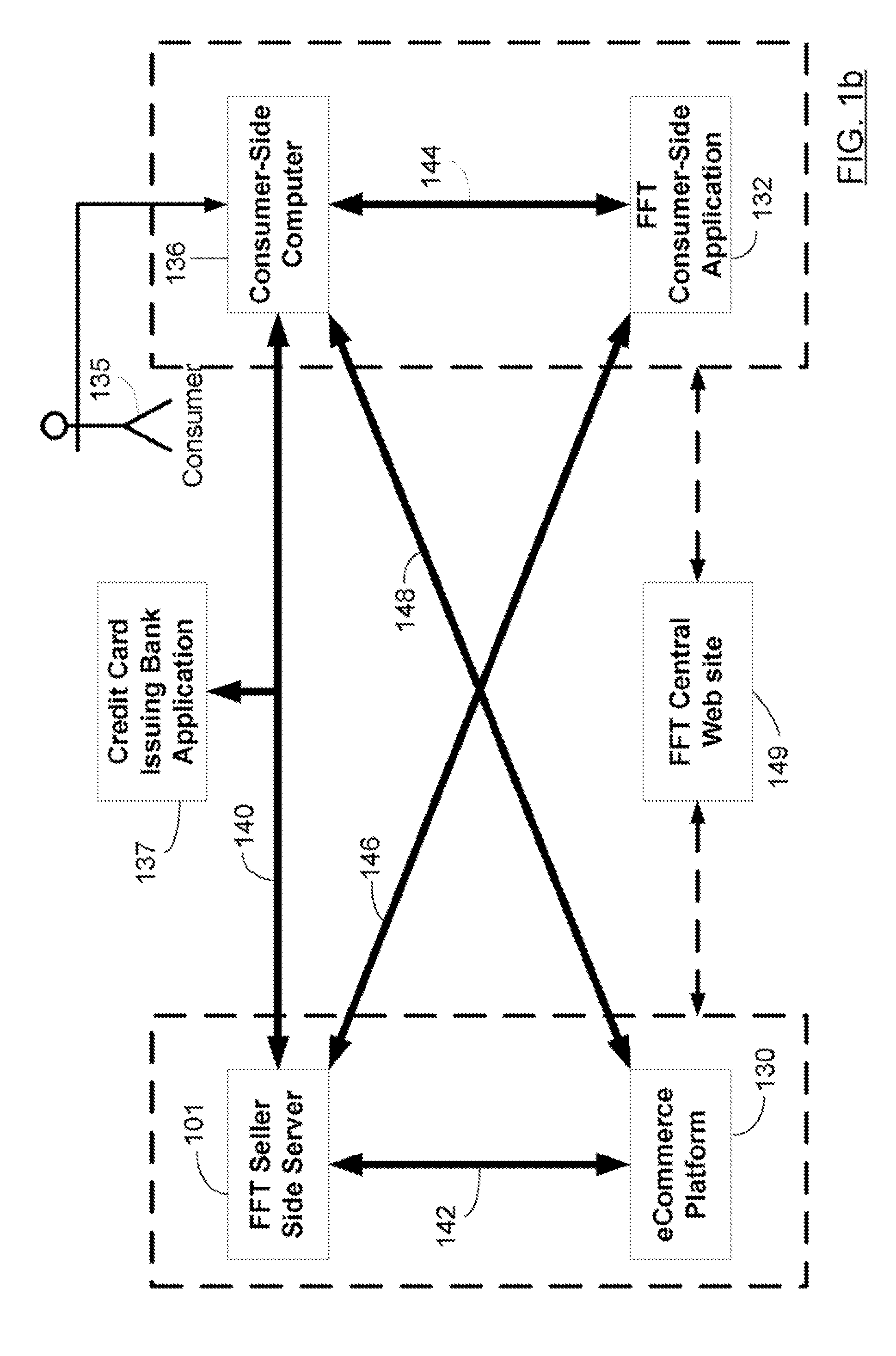

Systems and methods for facilitating electronic transactions and deterring fraud

Systems and methods are described for providing fraud deterrents during e-commerce, e-transactions, and digital rights management and access. One or more fraud deterrents may be automatically selected by a client, seller, bank, or other 3rd party and may be implemented or presented to the client as a potential fraud deterrent option that may be chosen. Fraud deterrent options may be provided which are associated with particular aspects of the transaction including a client's profile, the value of an item, or the preferences of the seller. The fraud deterrent features can be provided as part of a digital shopping cart and may be highly customized by the client including allowing the client to customize conceptual passwords which are presented during subsequent transactions.

Owner:JOHN MICHAEL SASHA

Systems and Methods for Automatic and Transparent Client Authentication and Online Transaction Verification

Systems and methods are described for providing fraud deterrents, detection and prevention during e-commerce, e-transactions, digital rights management and access control. Fraud deterrent levels may be automatically selected by a requesting transaction approval entity server (and can be related to level of risk, or security, related to fraud) or may be selected by a consumer. These deterrent levels can determine the manner in which the transaction occurs as well as the types of information that must be provided and validated for successful approval of the transaction. The client can associate their credit card with a specific device, an e-identity, such as an instant messaging identity, and the e-identity is contacted as a part of finalizing a payment transaction so that a client response of ‘approve’ or ‘reject’ can be obtained. The anti-fraud technology also provides for management and storage of historical transaction information. Entity-to-client communication occurs according to merchant permission parameters which are defined by the client and which enable messages sent by the entity to be automatically allowed, rejected, and managed in other ways as well.

Owner:JOHN MICHAEL SASHA

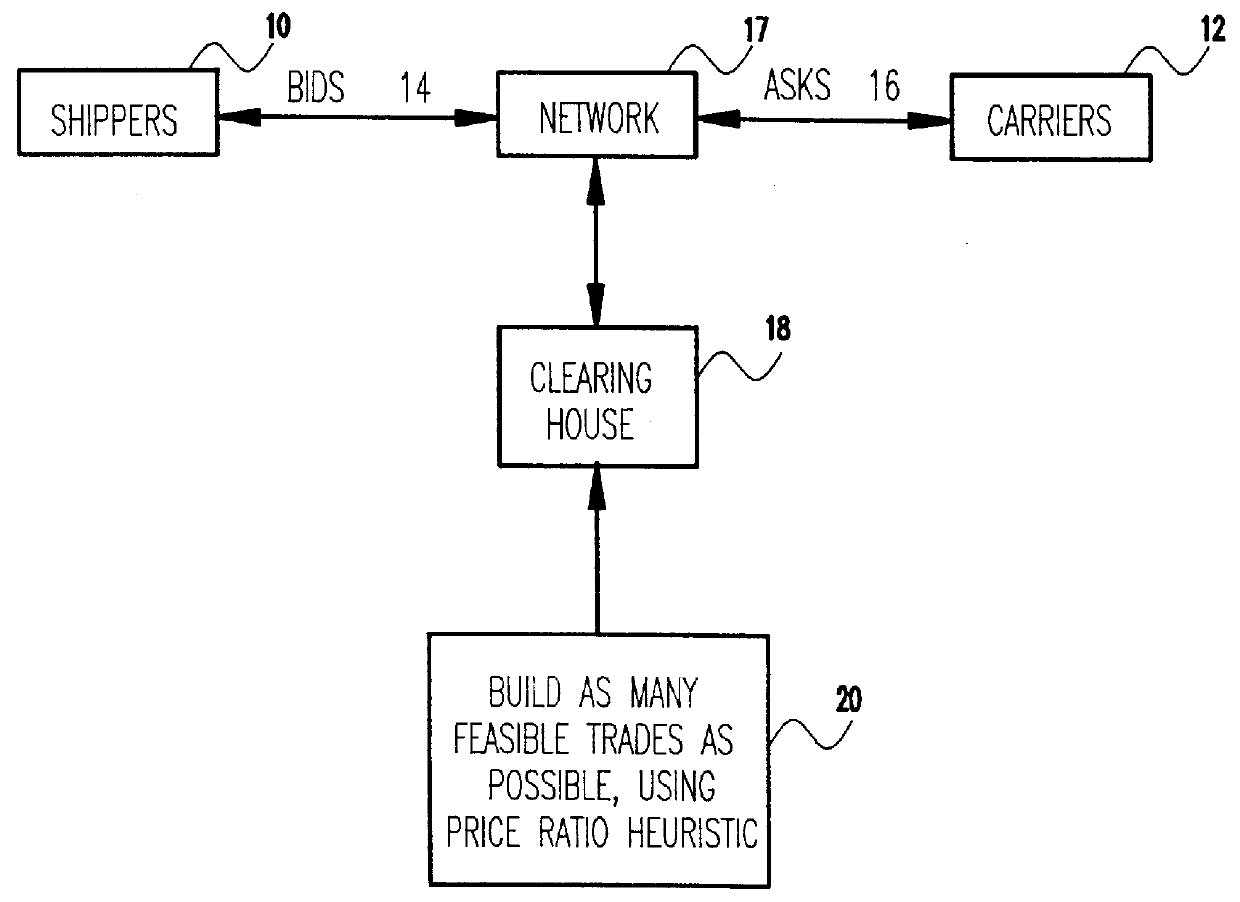

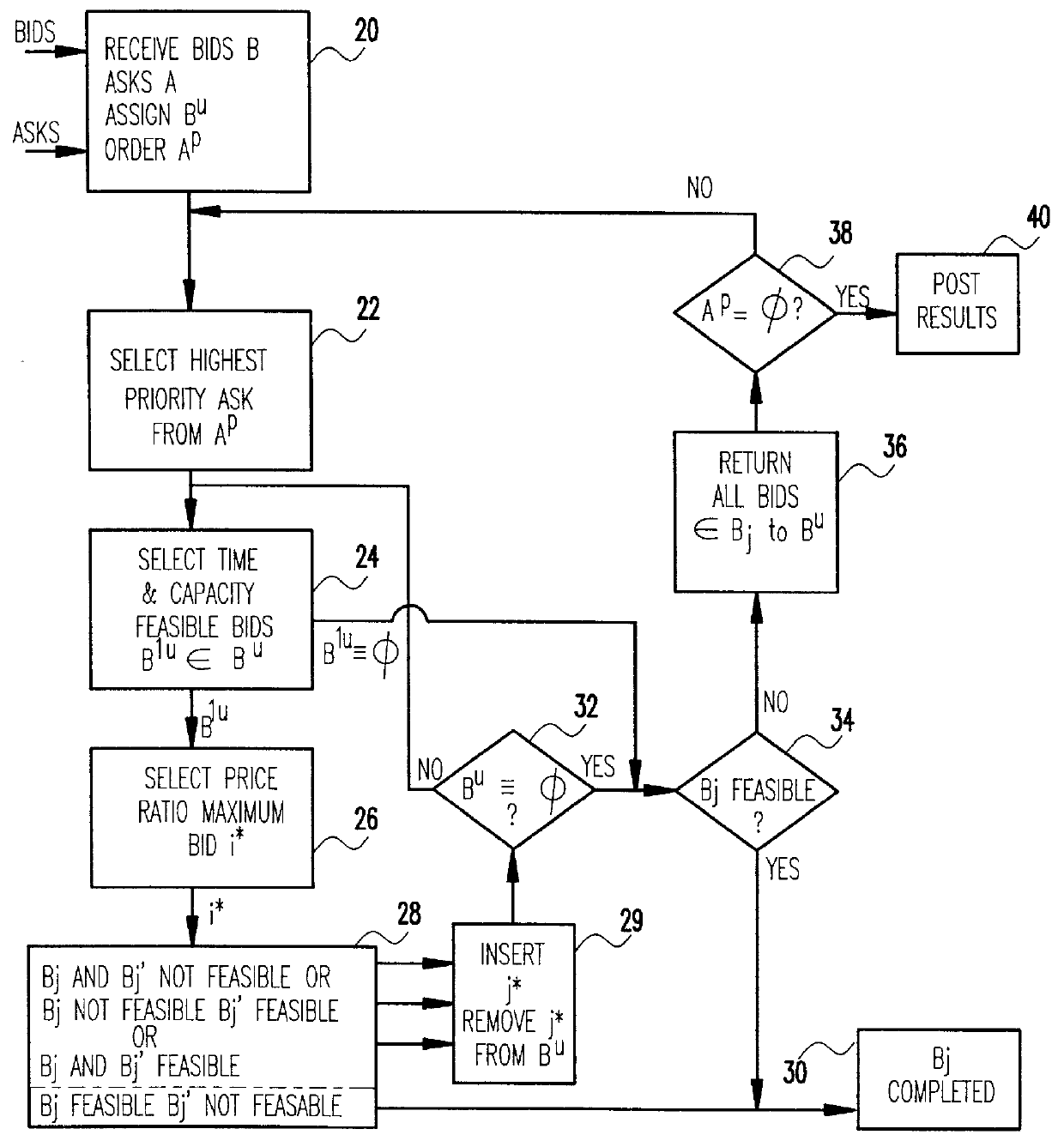

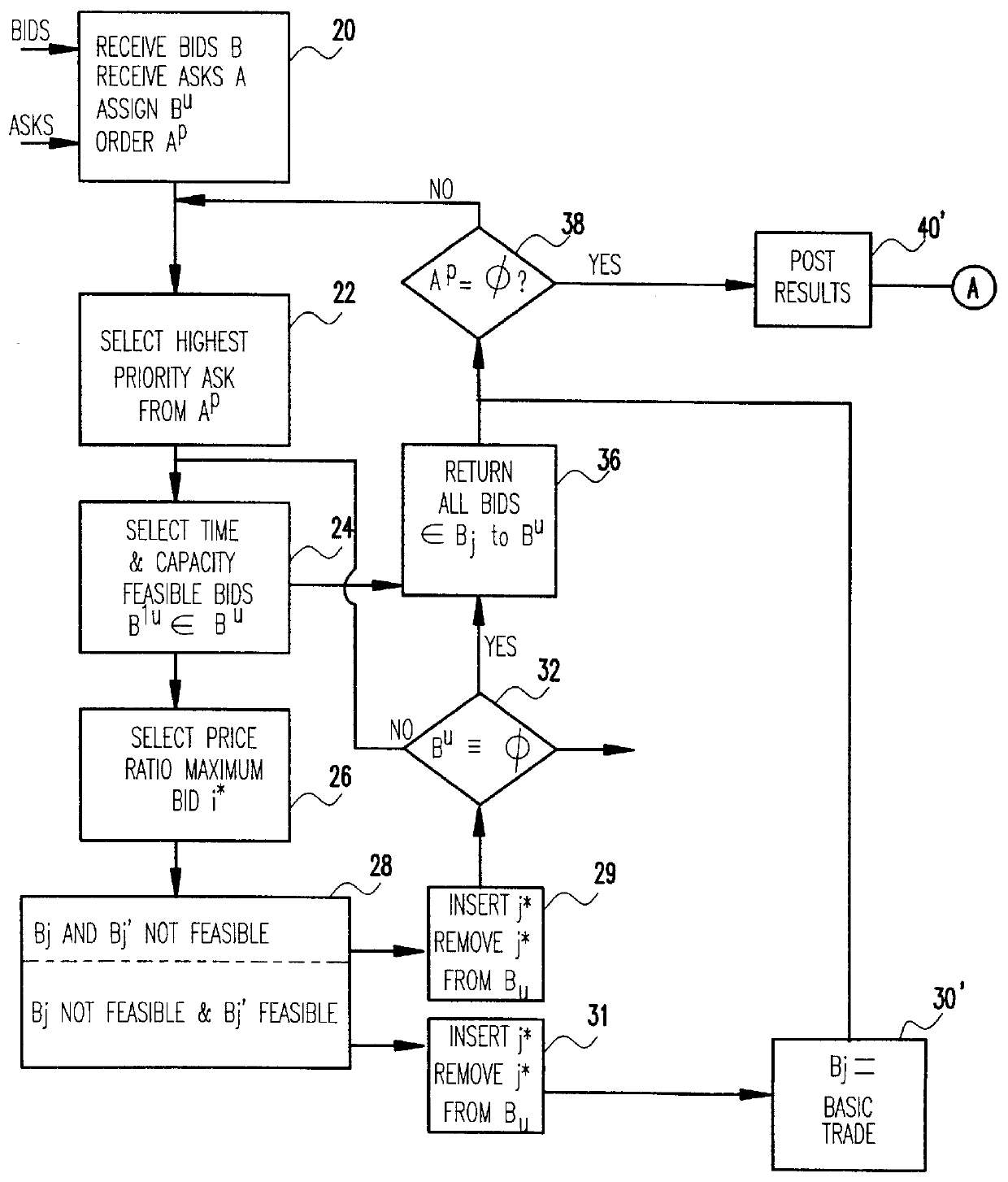

Method and apparatus for electronic trading of carrier cargo capacity

A computer-implemented method for double auction trade-building by matching, based on feasibility and price / cost heuristics, a plurality of electronically posted bid with a plurality of electronically posted ask records. A one-pass sequential trade building method selects ask records one at a time and sequentially inserts, in one pass, as many of the bid records as possible while maintaining feasibility criteria. A two pass sequential trade building method inserts the bid records in two stages, the first terminating when the trade becomes feasible and the second when no further bids can be inserted.

Owner:IBM CORP

Electronic trading system

An anonymous trading system comprises one or more matching engines, one or more market distributors and one or more trader terminals for input of orders from institutions trading on the system. The trader terminals are connected to the system through bank nodes. A broker terminal is connected through a bank node and enables voice brokers to trade on the system on behalf of client traders. The voice brokers terminal can be configured for any client trader and will display the market view for that trader. Trades in which the broker terminal participates are not concluded until a manual credit check has been performed.

Owner:EBS GROUP

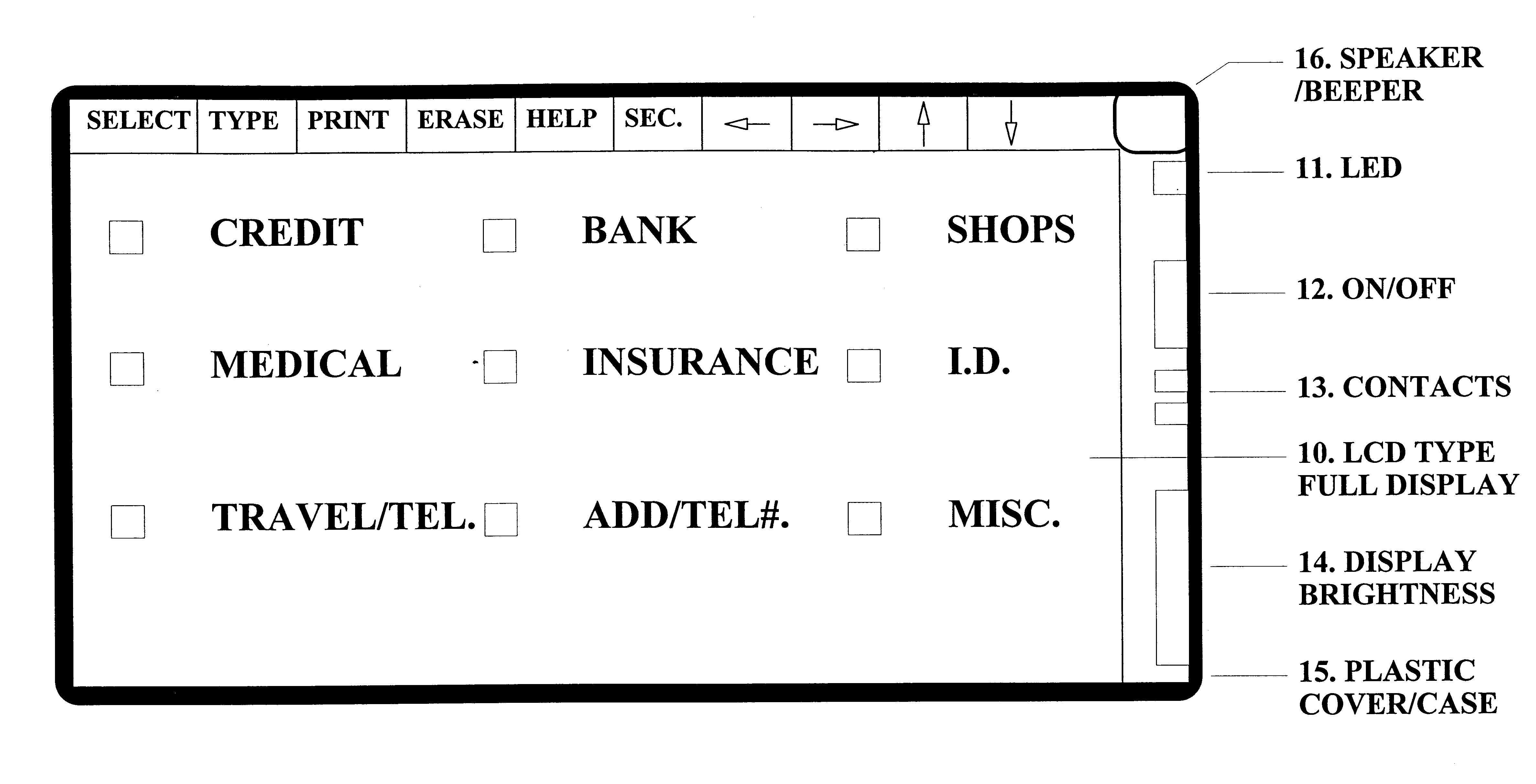

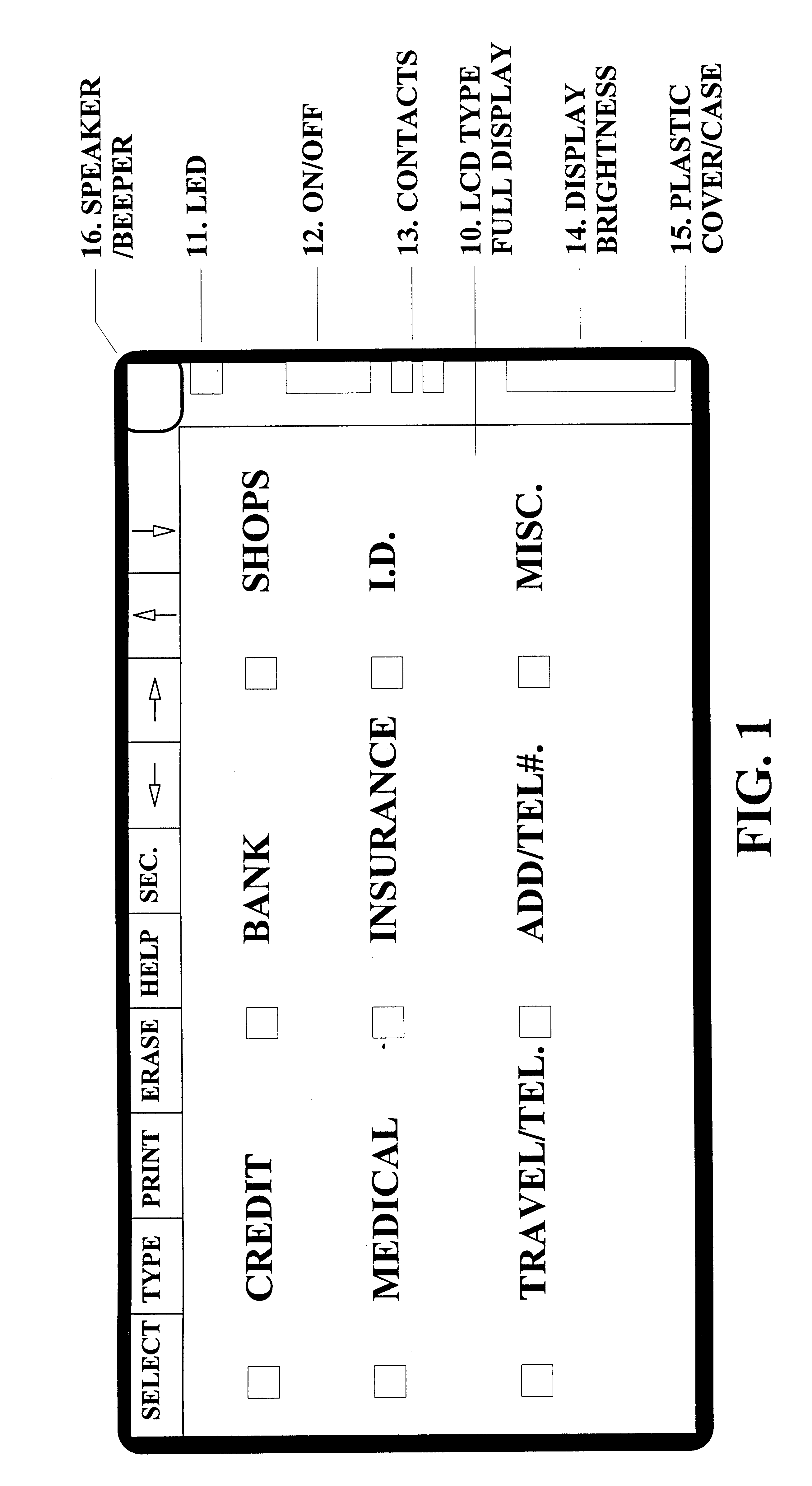

Device, system and methods of conducting paperless transactions

InactiveUS20050247777A1Eliminate pointEliminate all paper transactions and billsCash registersPatient personal data managementCredit cardDisplay device

A universal electronic transaction card (“UET card”) is capable of serving as a number of different credit cards, bank cards, identification cards, employee cards, medical cards and the like. The UET card includes storage elements, an input interface, a processor, a display, and a communications interface. In a preferred embodiment, the UET card stores transactional information to eliminate paper receipts and includes security features to prevent unauthorized use. The UET card may also be used to replace conventional currency and traveler's checks, and may be configured to store and display promotional information, such as advertising and incentives. A communications interface unit (“CIU”) may be provided to interface between the UET card and a personal computer, automatic banking terminal (commonly referred to as ATM machines) and / or an institutional mainframe computer. CIU devices may include electrical contact for recharging a UET card. A system of utilizing the UET card is also provided which includes UET cards and CIU devices which enable the transmission of information between point of sales (or point of transactions) computers and the UET cards. The system further includes point of sales computers configured to communicate with the UET card and with service institution computers. The invention also includes a health care management system utilizing UET cards. In the health care management system, all medical information for a patient may be stored in the UET card so that when a patient receives services from a health care provider, that health care provider connects the patient's UET card to the health care provider's computer system and can then obtain all pertinent medical information concerning the patient, including the patient's medical history, insurance information and the like. In addition, the treatment or services provided by the health care provider are stored in the patient's UET card. The invention also includes methods of issuing an account authorization to a UET card, a method of transferring transactional and account information between a UET card and a personal computer or a mainframe computer, a method of using the UET card as a remote terminal for a mainframe computer, and a method of conducting an electronic transaction.

Owner:C SAM INC

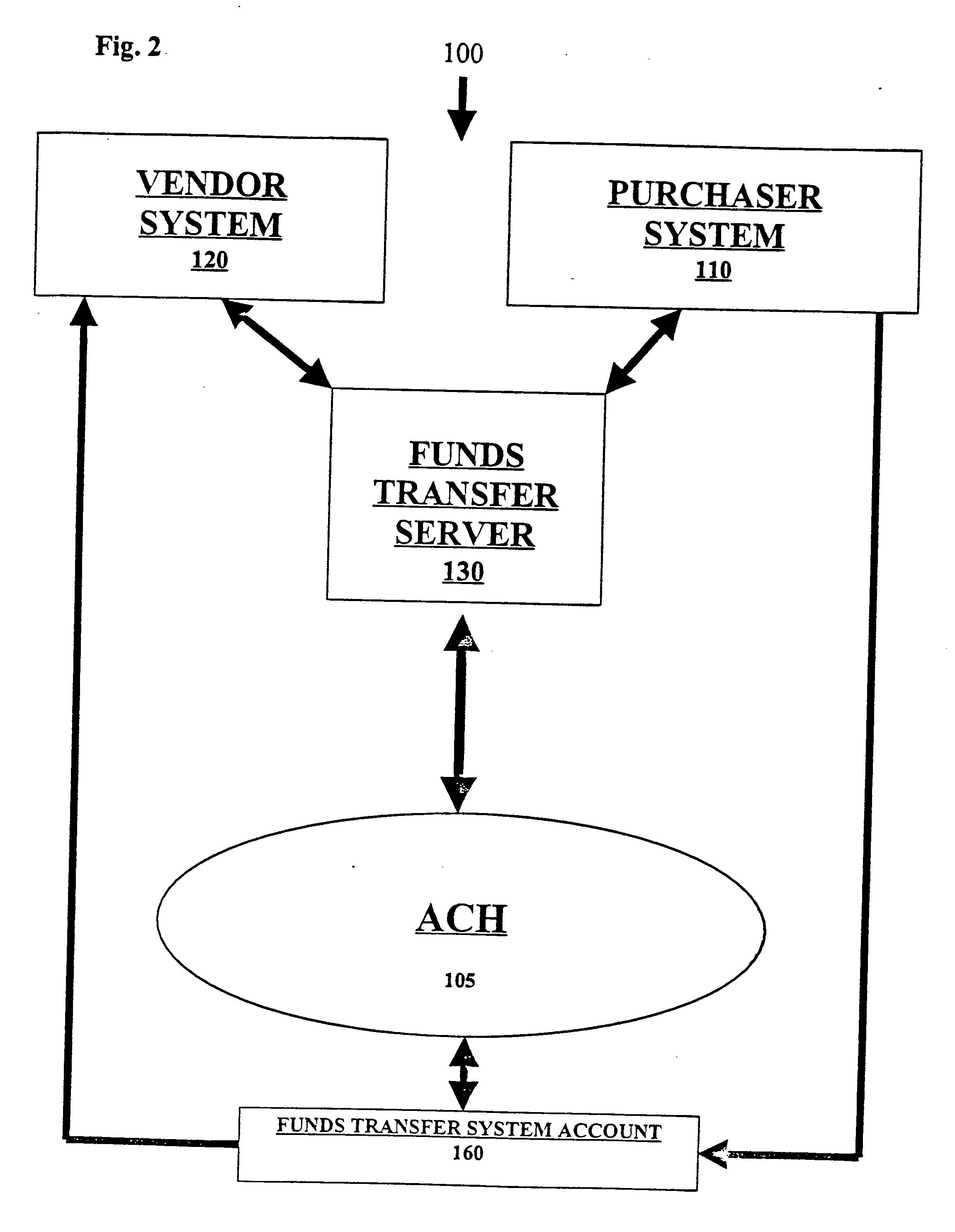

Electronic purchasing and funds transfer systems and methods

InactiveUS20080162350A1Easy accessFraud can be limitedFinanceBuying/selling/leasing transactionsTransfer systemPurchasing

An electronic transaction method, funds transfer apparatus and method for facilitating a funds transfer. The methods comprise sending information from a purchaser or payor to a funds transfer system separate from a vendor system or payee, validating and confirming personal financial information at the funds transfer system, and transferring funds from a purchaser or payor account to the vendor or a payee account without exposing either party's financial and account information to the other. Additionally, a funds transfer apparatus is disclosed comprising connections to a payor and payee system and mechanisms for receiving and validating party and transaction information and a mechanism for transferring funds from one party to the other.

Owner:THE WESTERN UNION CO +1

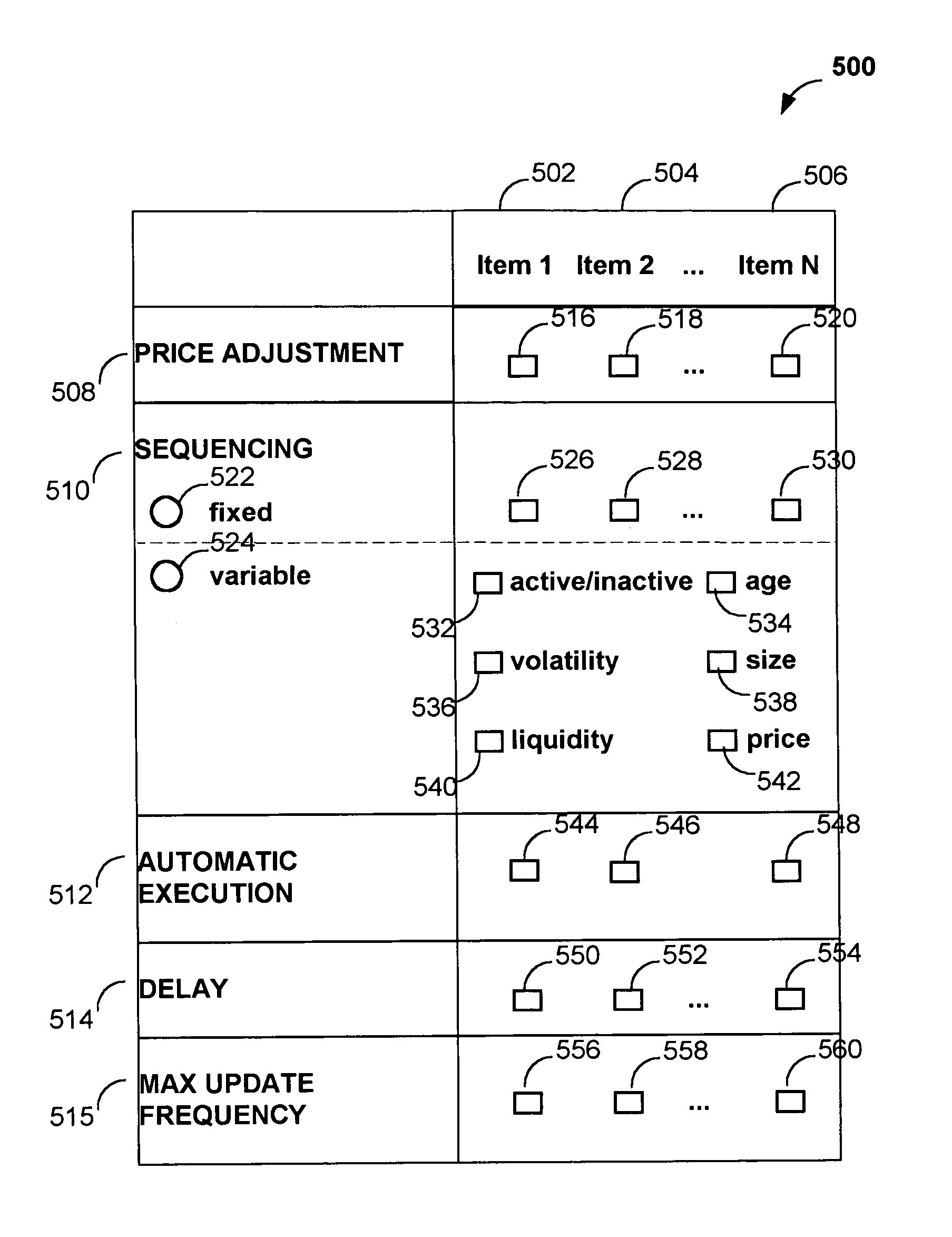

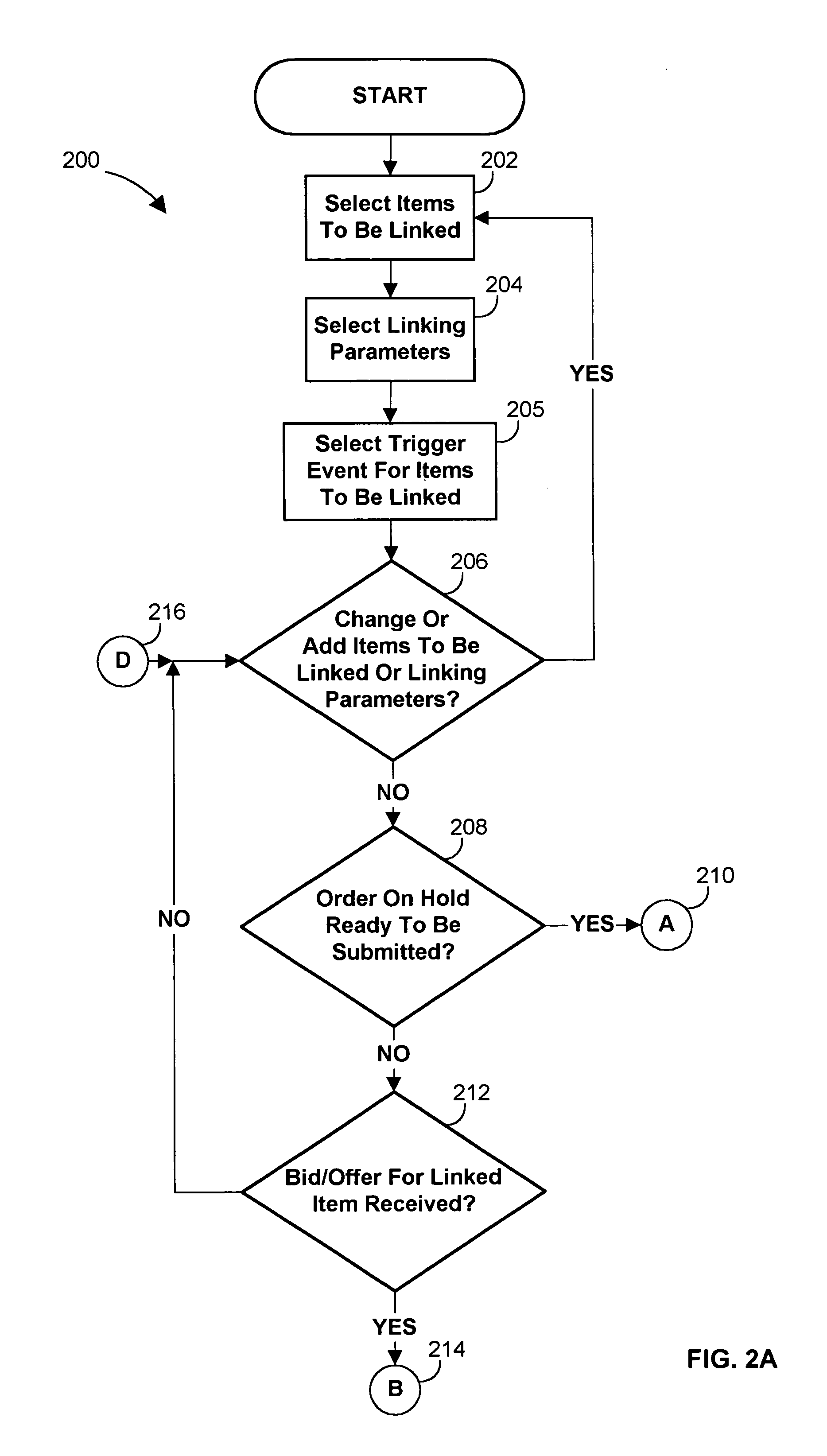

Systems and methods for linking orders in electronic trading systems

Owner:BGC PARTNERS LP

Methods and apparatus for conducting electronic transactions using biometrics

InactiveUS20050187883A1Improve reliabilityConfidenceDigital data processing detailsAnalogue secracy/subscription systemsBiometricsComputer science

A system and method for facilitating electronic transactions using a biometric are disclosed. The system for facilitating electronic transactions using a biometric comprises a smartcard-reader transaction system. The method comprises determining if a transaction violates an established rule, such as a preset spending limit. The method also comprises notifying a user to proffer a biometric sample in order to verify the identity of said user, and detecting a proffered biometric at a sensor to obtain a proffered biometric sample. The method additionally comprises verifying the proffered biometric sample and authorizing a transaction to continue upon verification of the proffered biometric sample.

Owner:LIBERTY PEAK VENTURES LLC

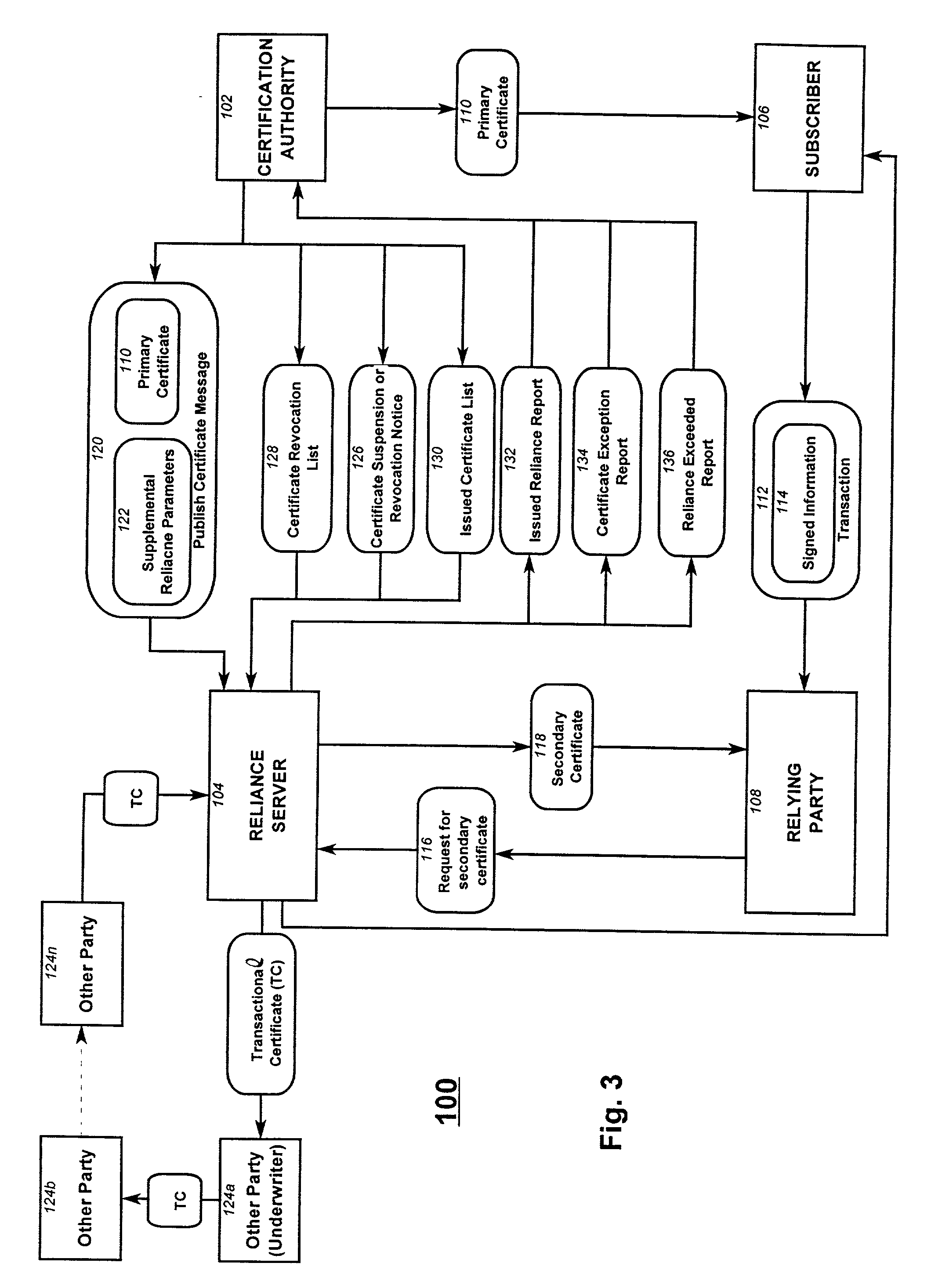

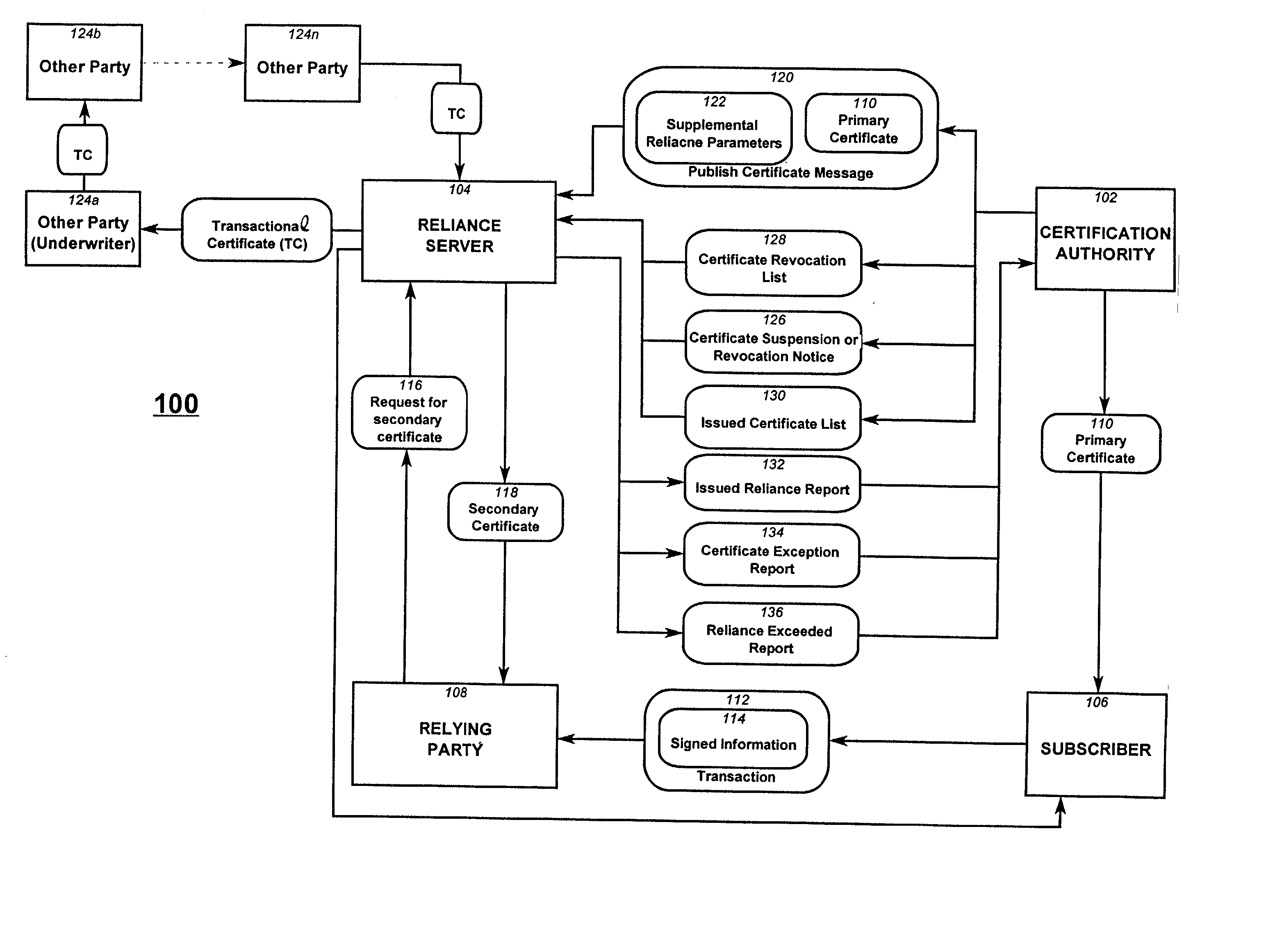

Reliance management for electronic transaction system

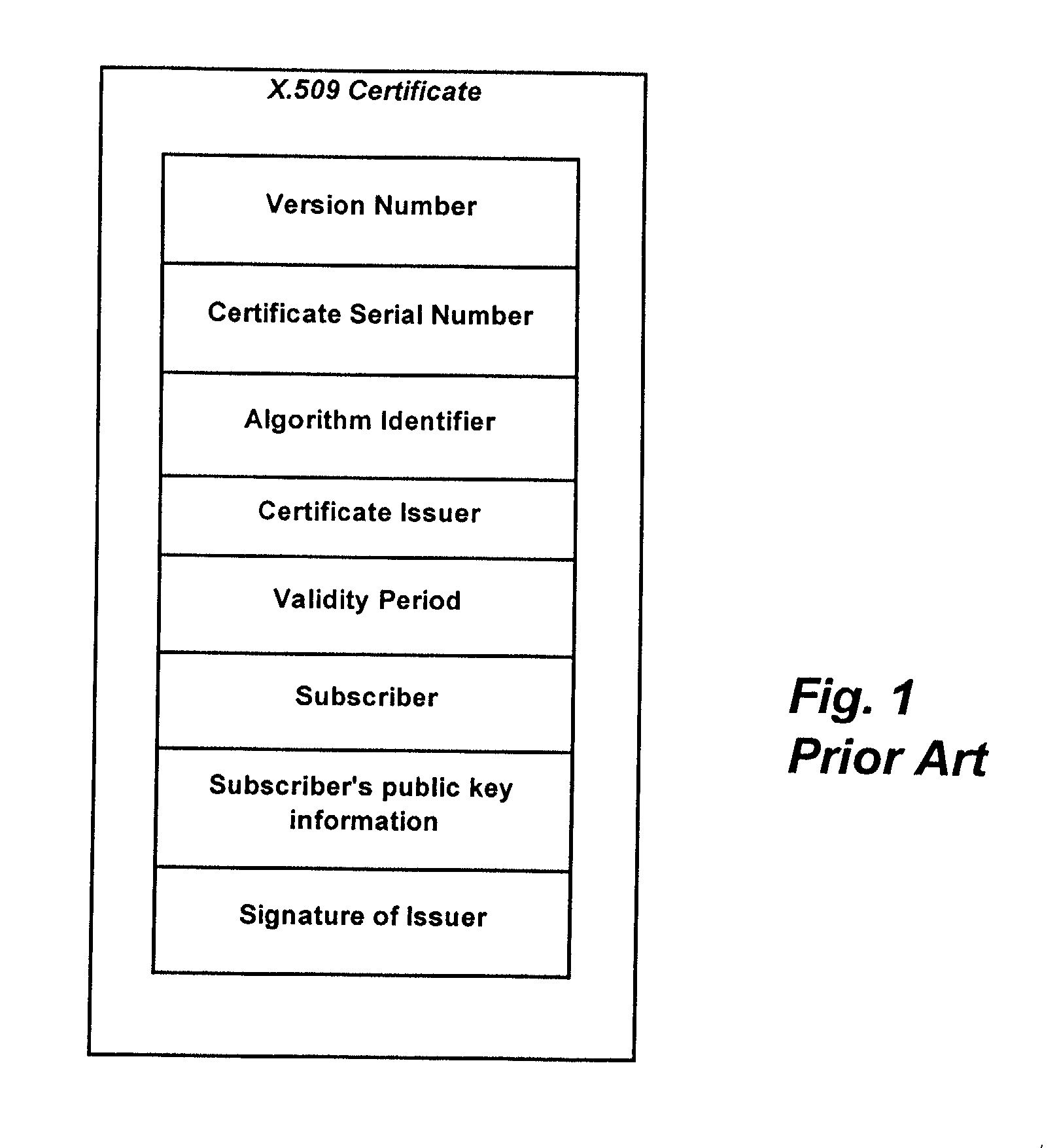

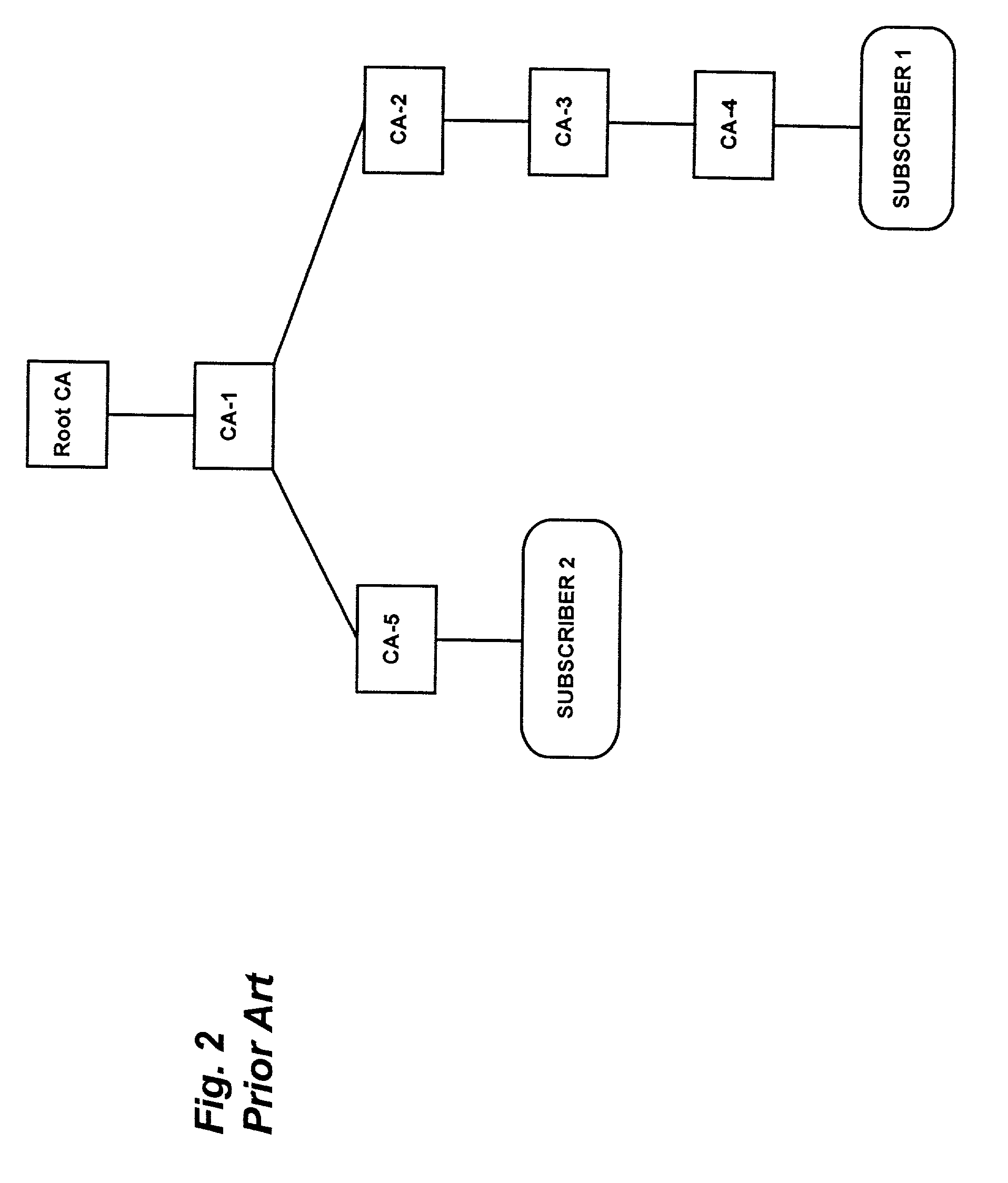

InactiveUS20010011255A1Complete banking machinesPublic key for secure communicationProxy certificateCertificate authority

A method of managing reliance in an electronic transaction system includes a certification authority issuing a primary certificate to a subscriber and forwarding to a reliance server, information about the issued primary certificate. The reliance server maintains the forwarded information about issued primary certificate. The subscriber forms a transaction and then provides the transaction to a relying party. The transaction includes the primary certificate or a reference thereto. The relying party sends to the reliance server a request for assurance based on the transaction received from the subscriber. The reliance server determines whether to provide the requested assurance based on the information about the issued primary certificate and on the requested assurance. Based on the determining, the reliance server issues to the relying party a secondary certificate providing the assurance to the relying party.

Owner:CERTCO

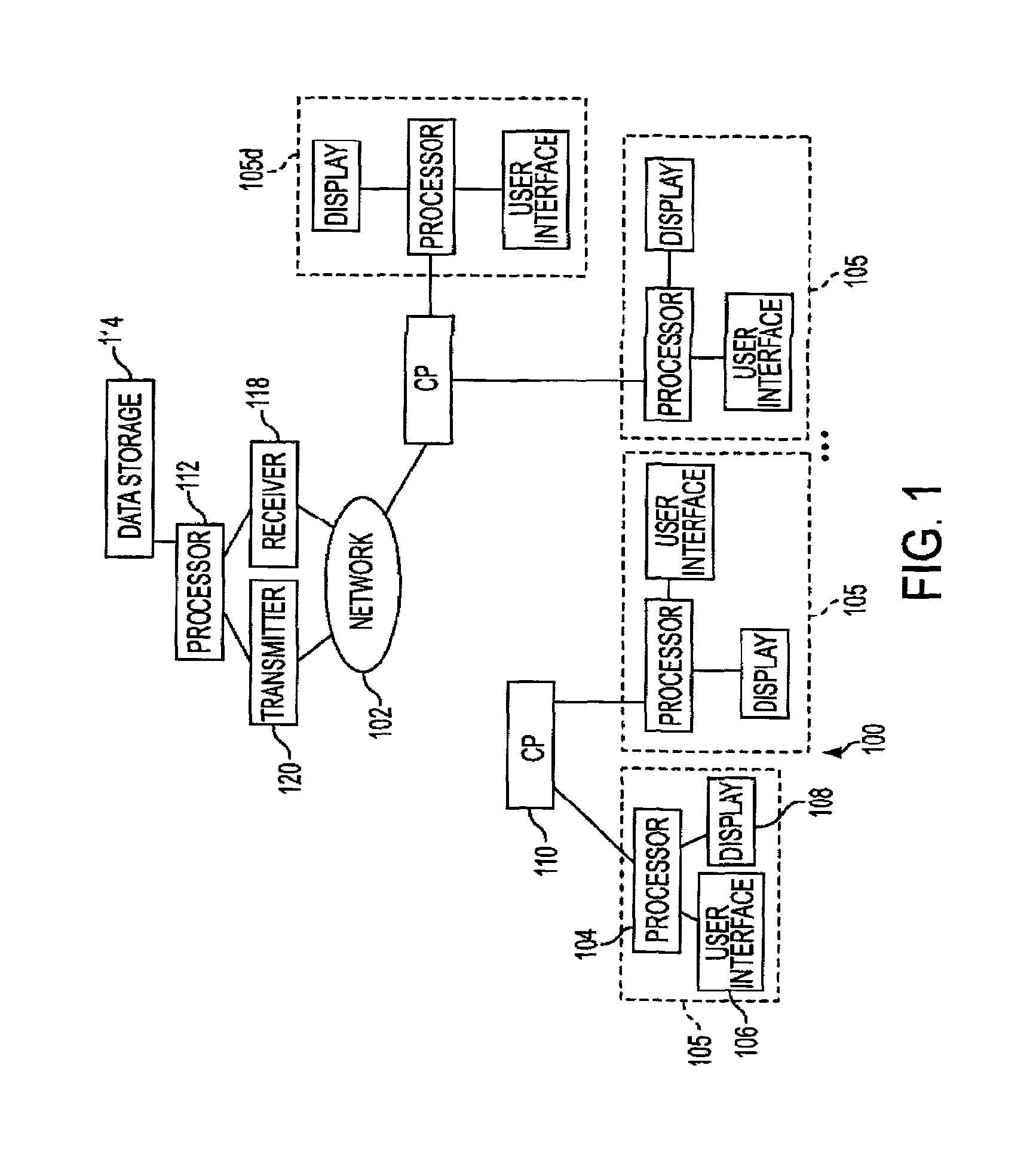

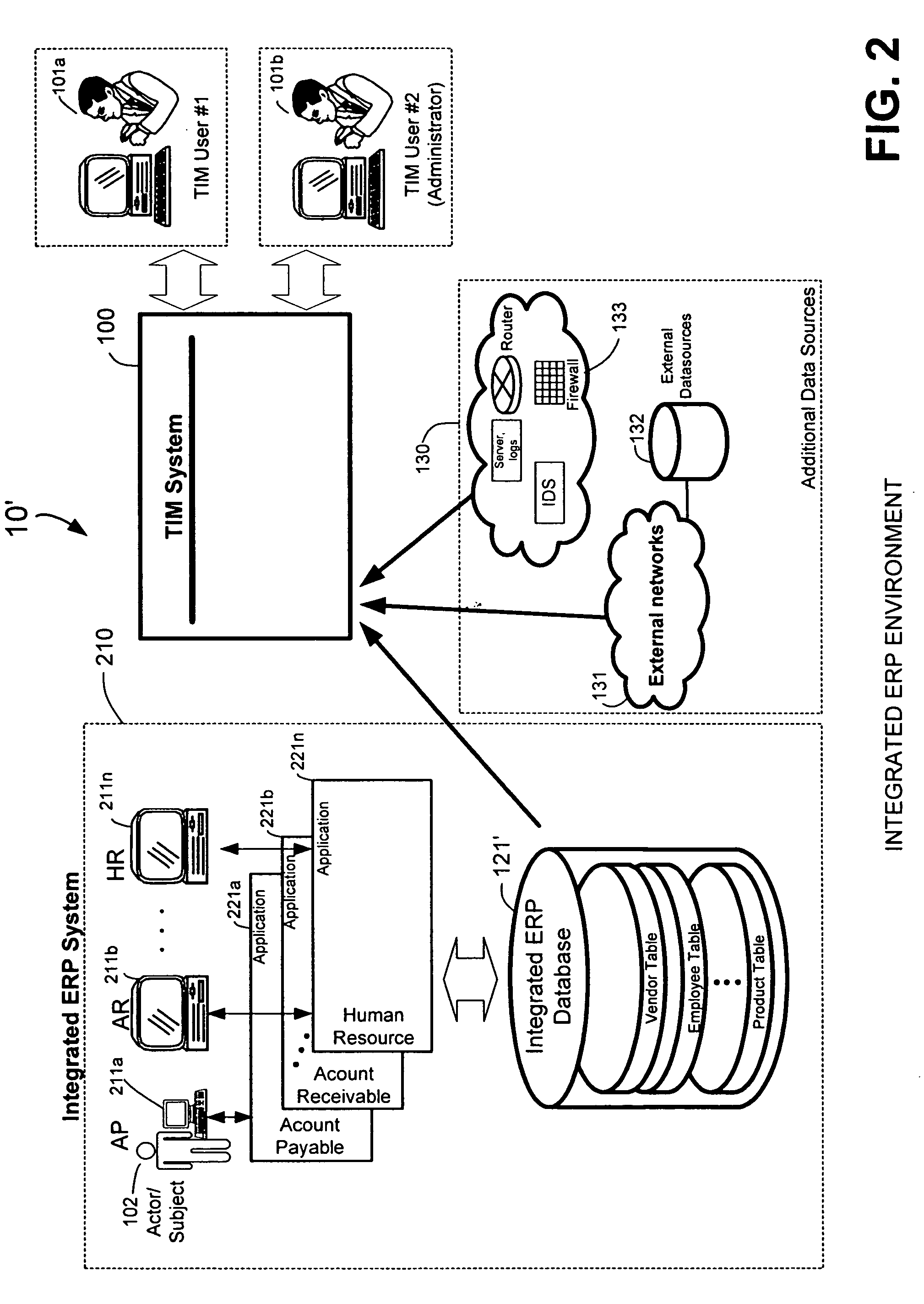

Methods and systems for transaction compliance monitoring

InactiveUS20050209876A1Low costQuality improvementDigital data information retrievalFinanceCompliance MonitoringData source

An automated transaction integrity monitoring system (100) operative to monitor electronic transactions of an enterprise and detect exceptions indicating noncompliance with enterprise policies. An extractor (140) obtains data from heterogeneous data sources such as enterprise databases. A staging database (155) caches data from the data sources. A mapper (150) maps enterprise data into an enterprise ontology used to express enterprise policies. A knowledge base (165) stores computer-executable policy statements, extractor data, and mapper data. A monitoring database (175) stores data mapped in the enterprise ontology. A collaborative reasoning engine (CORE) (160) executes policy statements against the monitoring database and determines exceptions. An exceptions database (185) stores exceptions from CORE. A case management system (190) provides for analysis and tracking of exceptions.

Owner:OVERSIGHT TECH

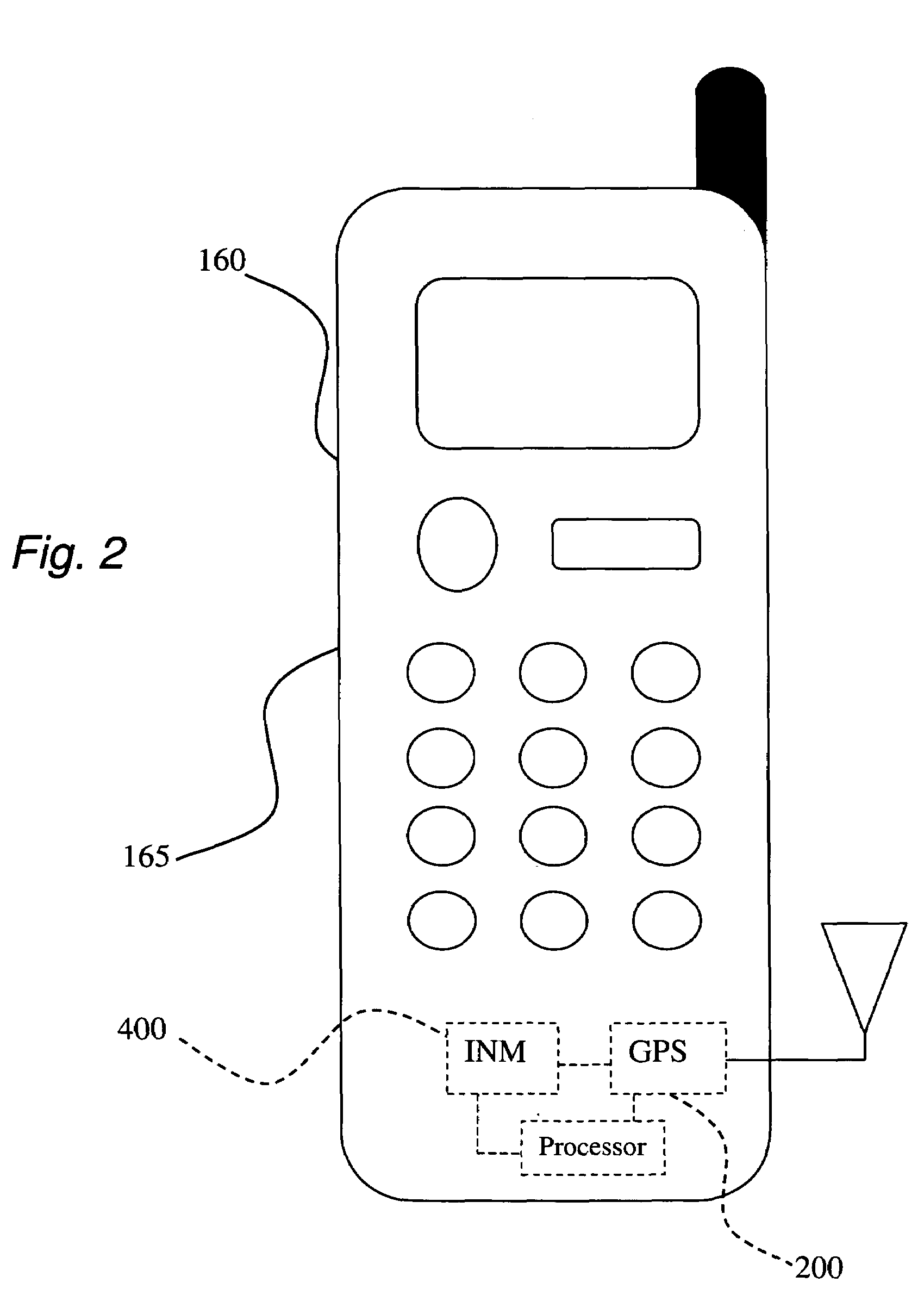

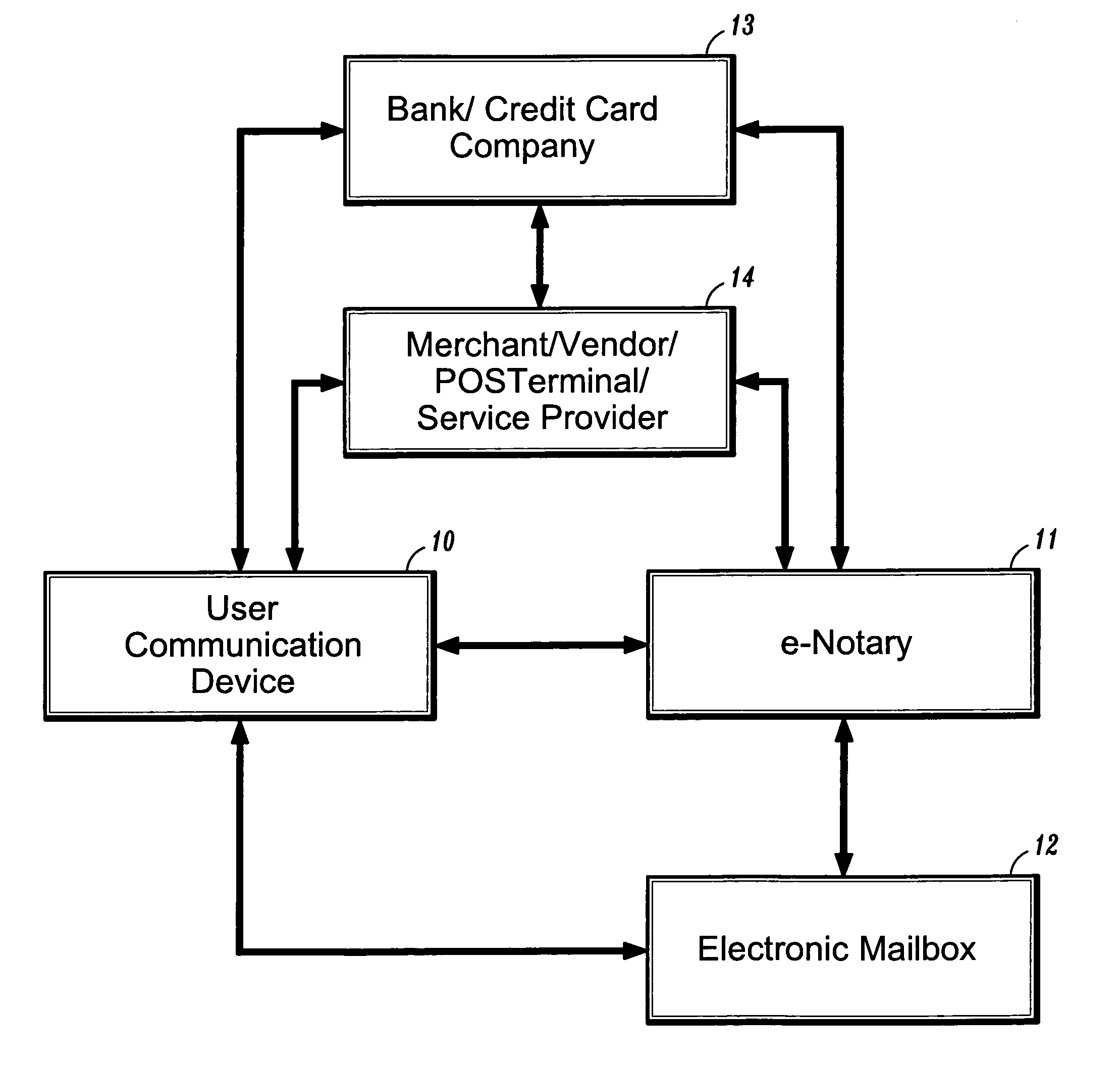

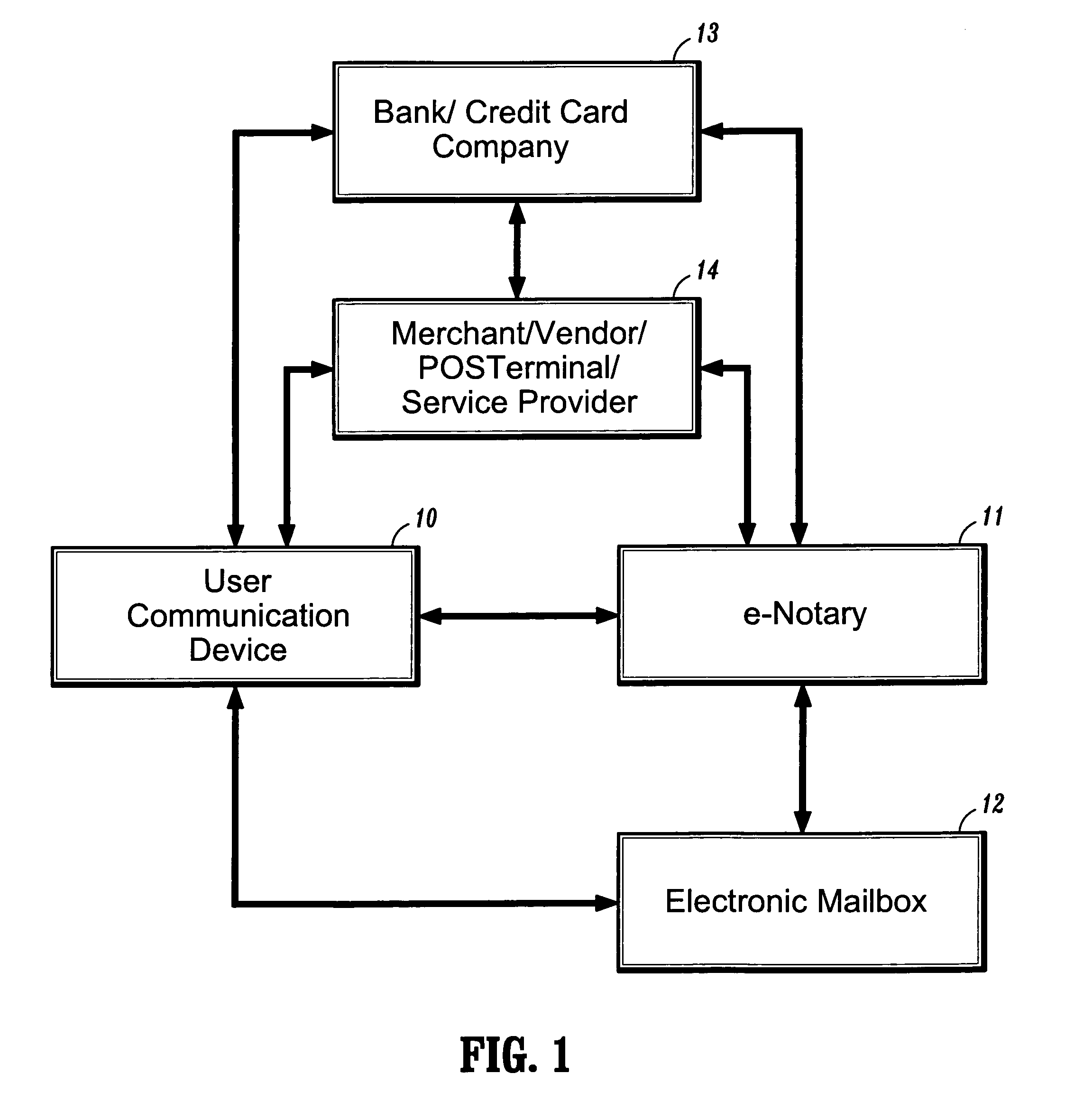

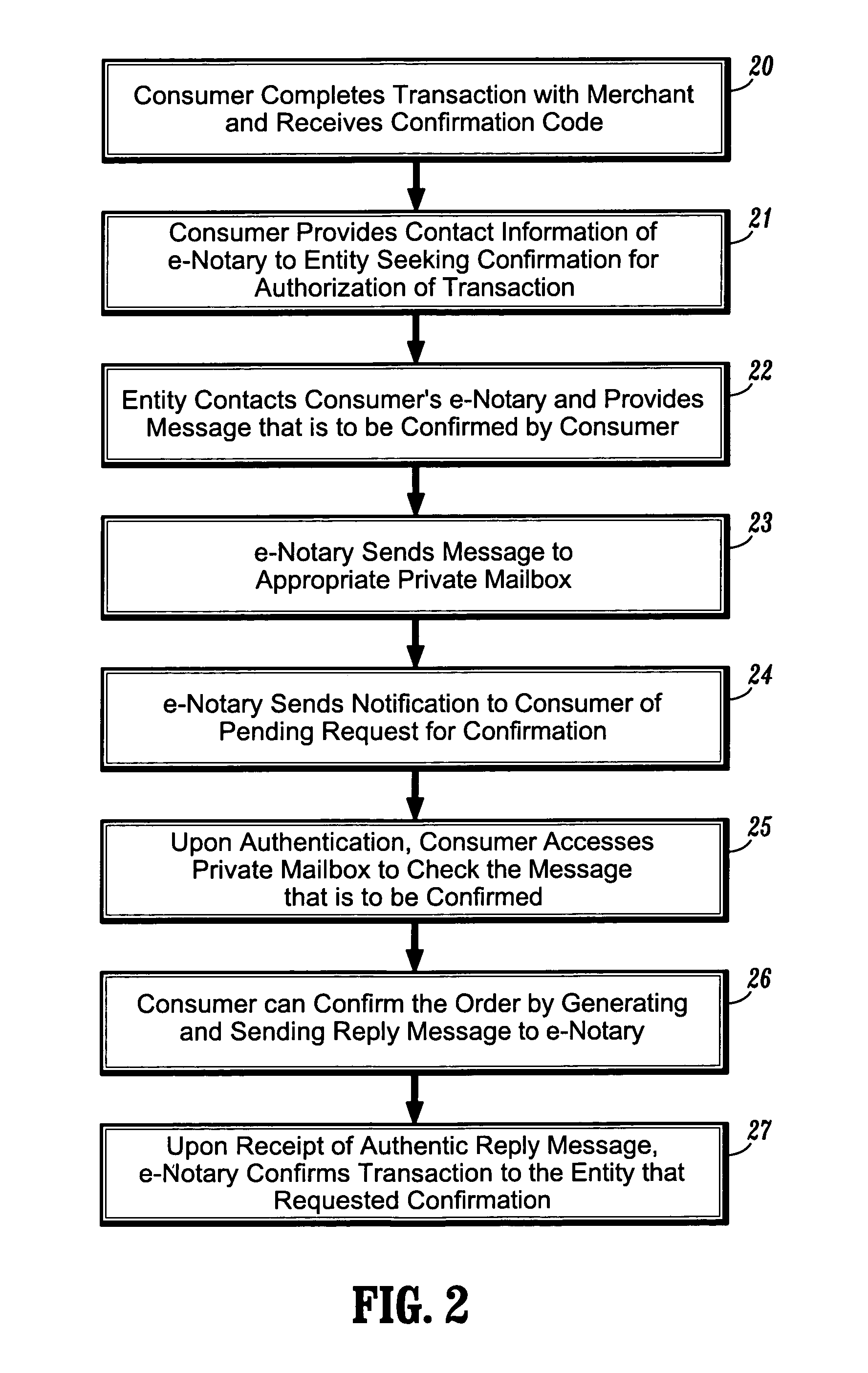

System and method for confirming electronic transactions

Systems and methods for providing user-confirmation of an electronic transaction and in particular, protocols for enabling electronic signatures and confirmation of electronic documents and transactions such as electronic financial transactions and credit card payment. In one aspect, a method for confirming an electronic transaction, comprises the steps of: performing an electronic transaction between a first party and a second party; sending, by the second party, a request for confirmation of the electronic transaction to a predetermined, private mailbox associated with the first party; accessing the private mailbox by the first party; and sending, by the first party, a reply message to the request for confirmation to thereby confirm authorization of the electronic transaction.

Owner:PHONENICIA INNOVATIONS LLC SUBSIDIARY OF PENDRELL TECH +1

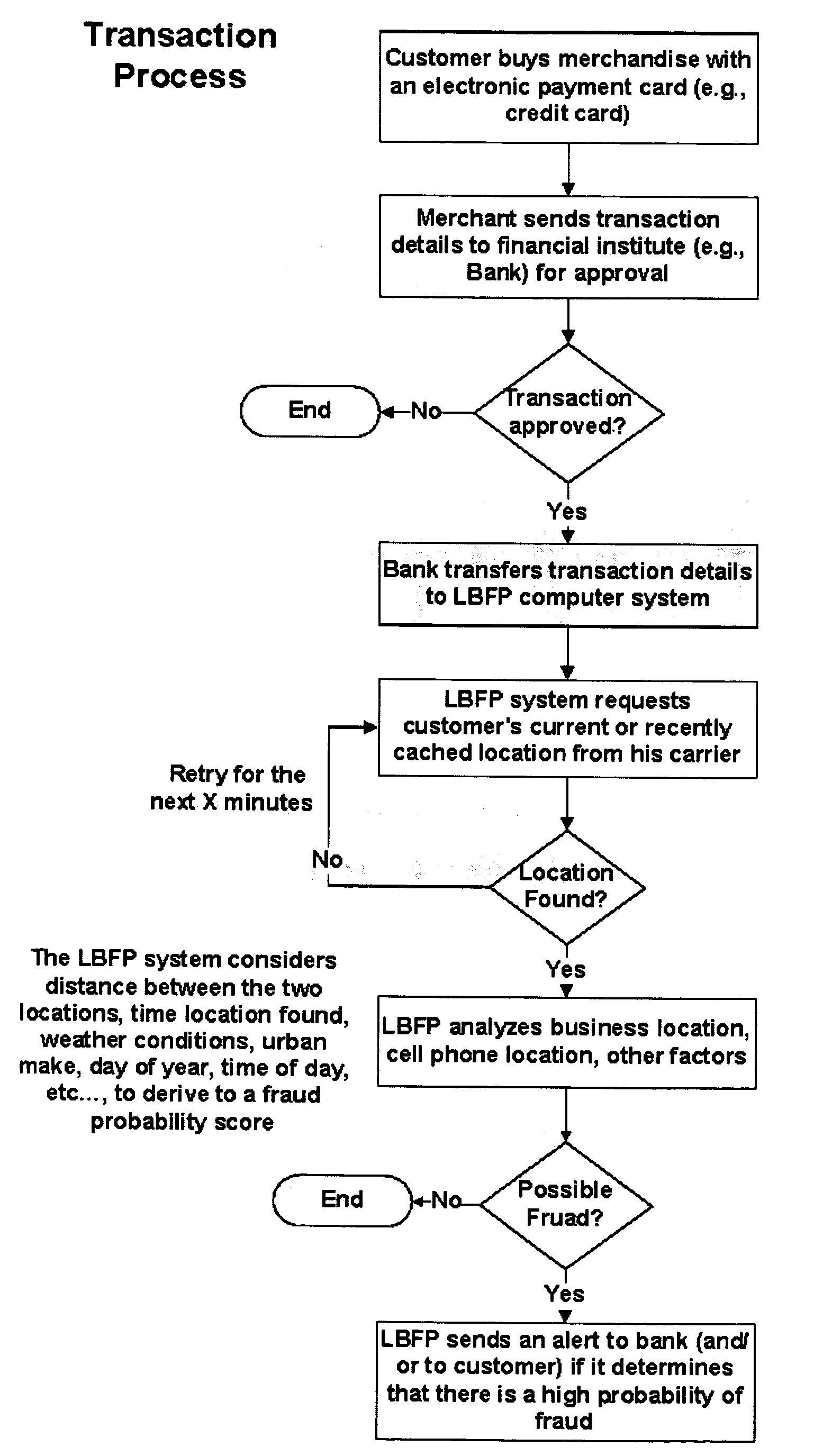

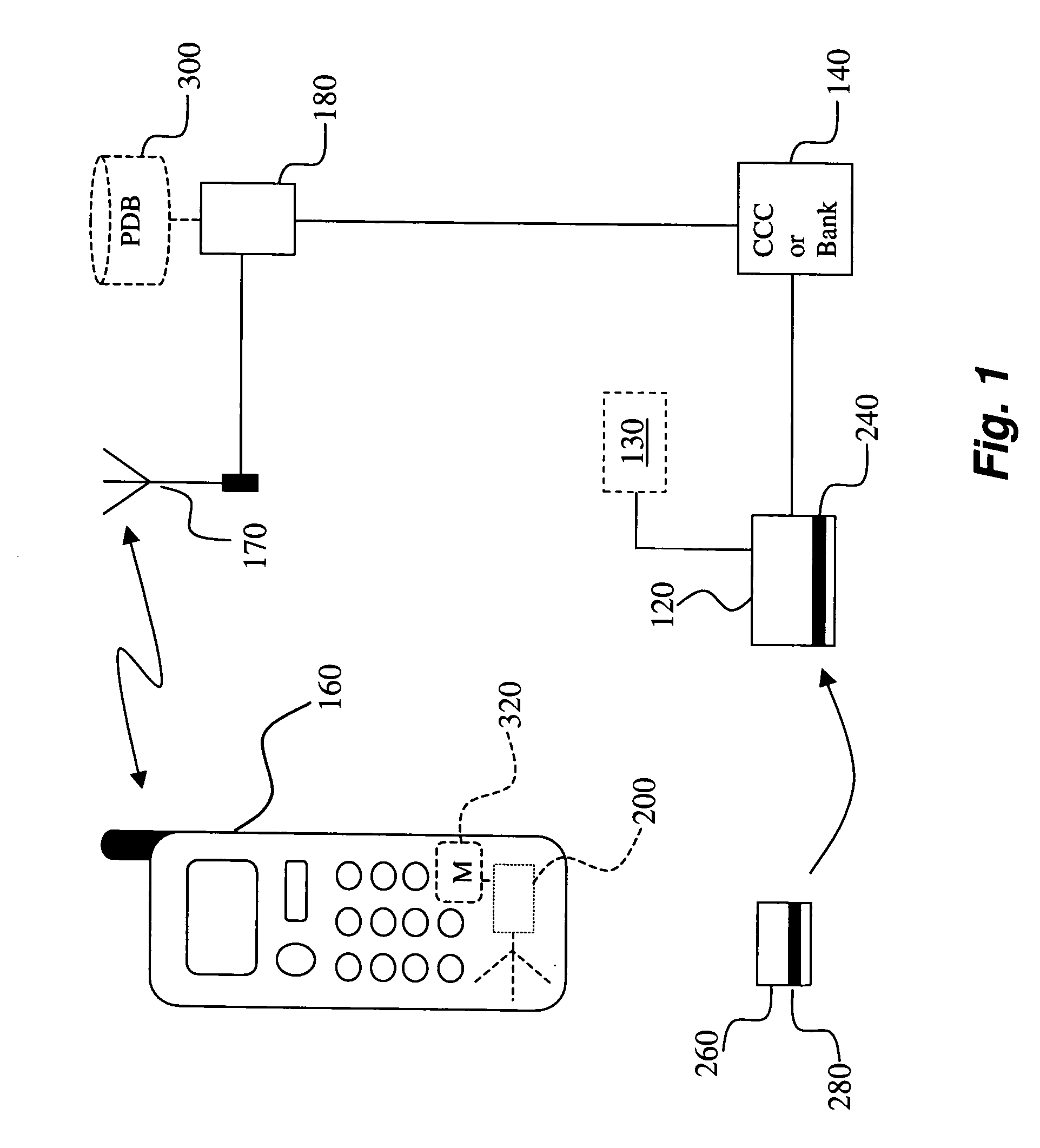

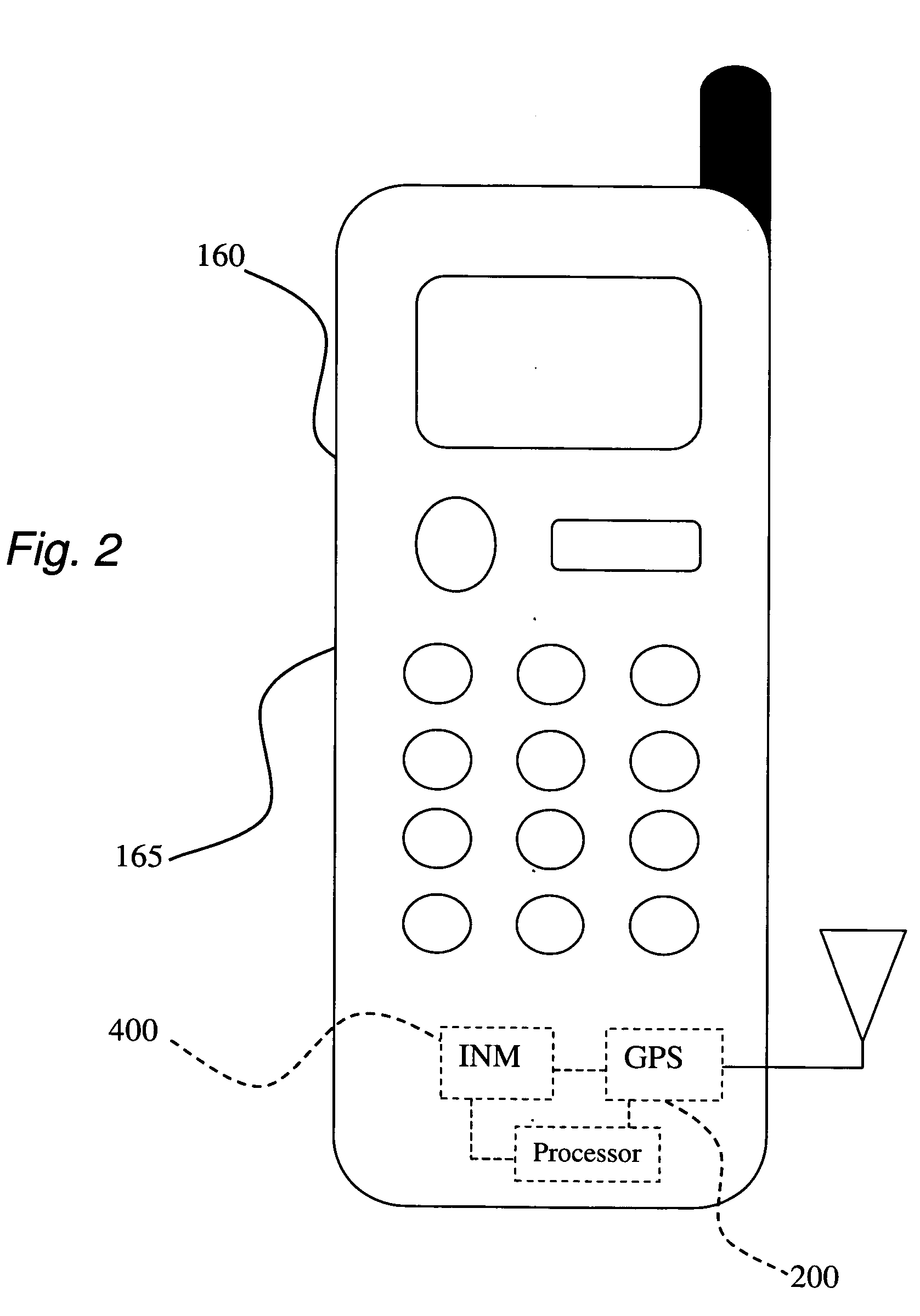

Method and system for monitoring electronic purchases and cash-withdrawals

A method for facilitating the detection of misuse of an identity during an electronic transaction. The invention comprises at least five embodiments. In a first embodiment, the method comprises the step of: receiving a notification to authenticate the use of an identity at a first location, wherein the identity is associated with a first wireless terminal; determining an approximate location of the first wireless terminal based on cached position information, the approximate location of the first wireless terminal being a second location; determining whether the first and second locations match in geographical proximity; and generating an alert if the first and second locations do not match in geographical proximity. In a second embodiment, an approximate location of the first wireless terminal is determined based on cached position information stored on a GPS position database.

Owner:LOCKIP

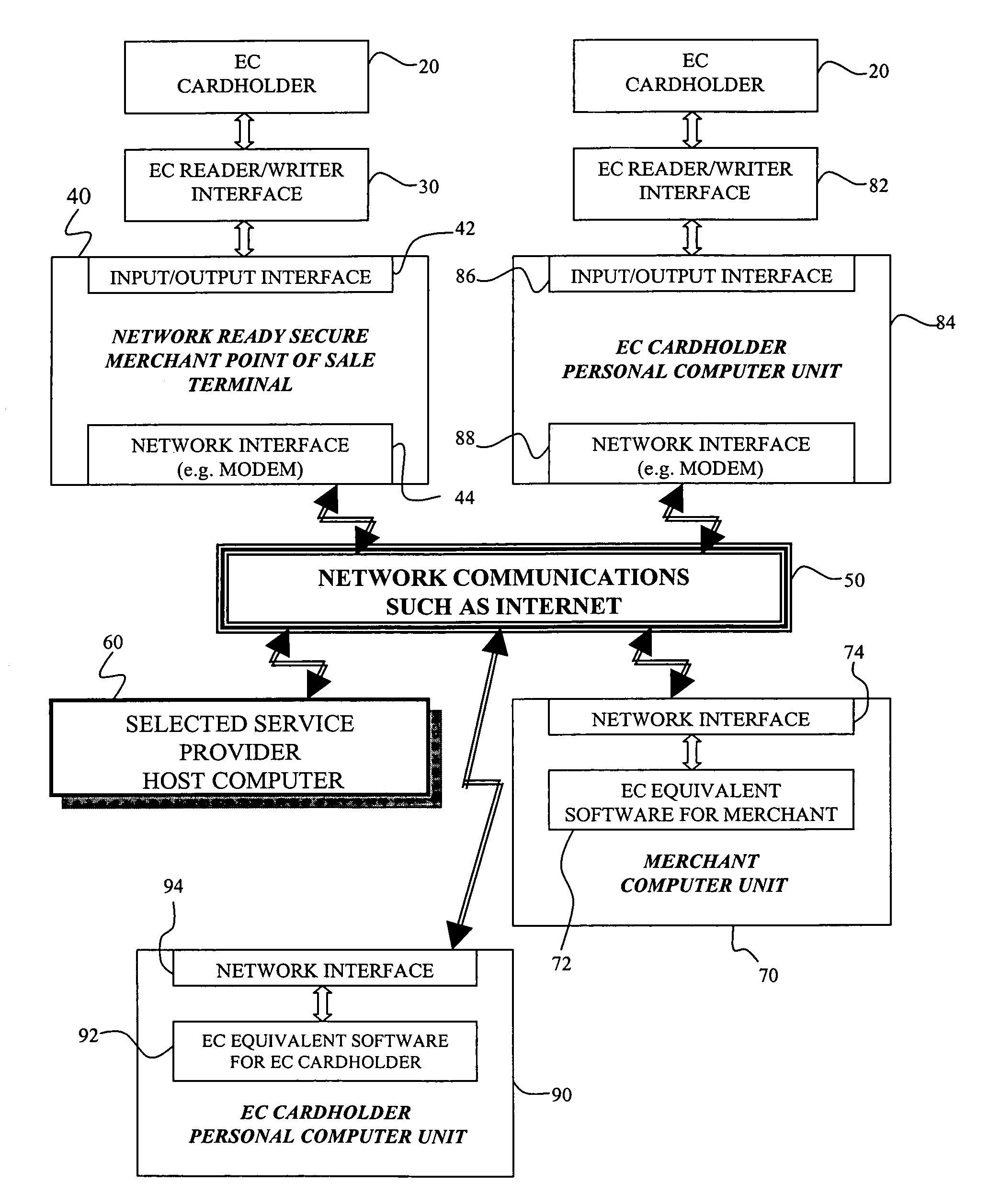

Cryptographic system and method for electronic transactions

InactiveUS7096494B1Key distribution for secure communicationFinanceCredit cardSecure Electronic Transaction

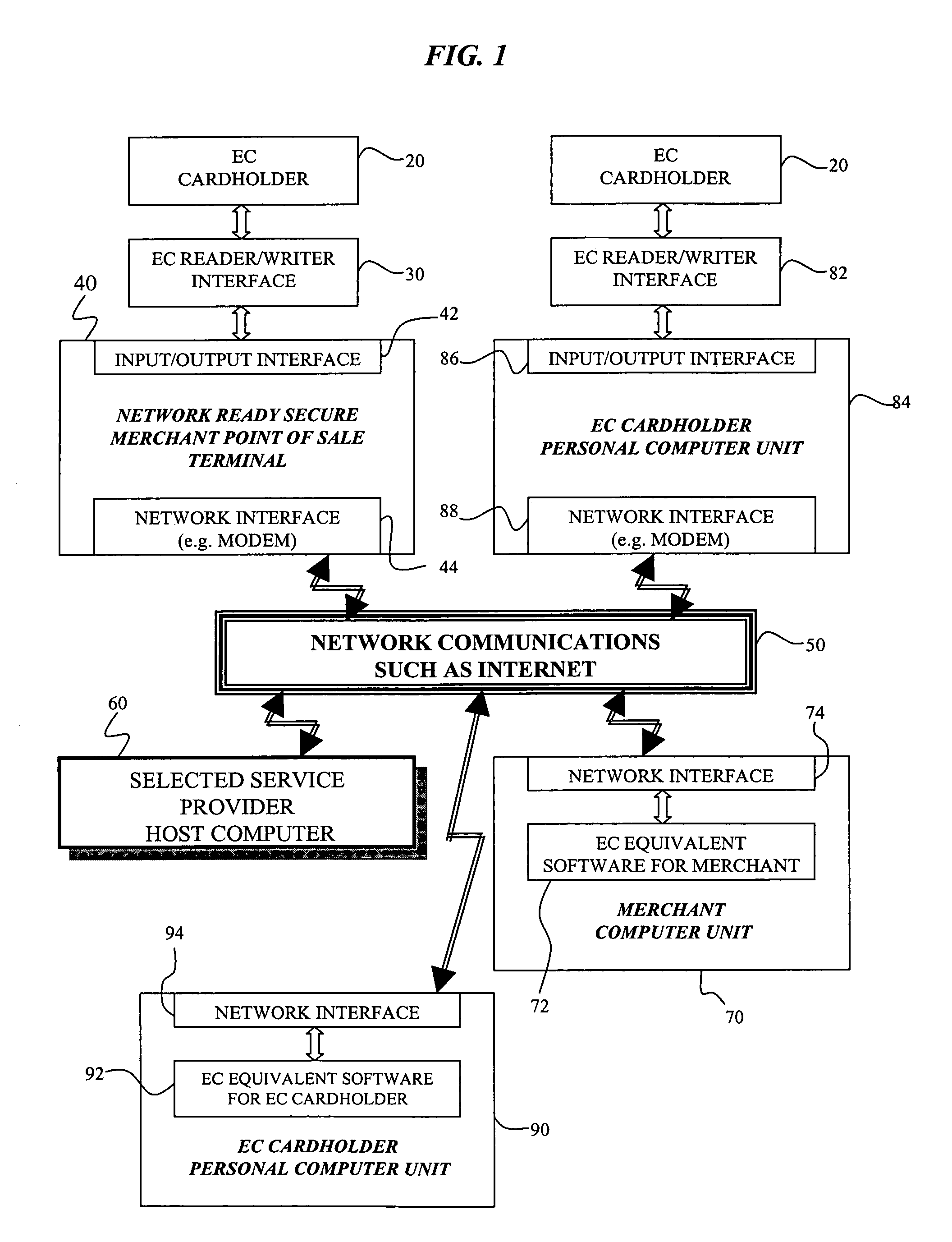

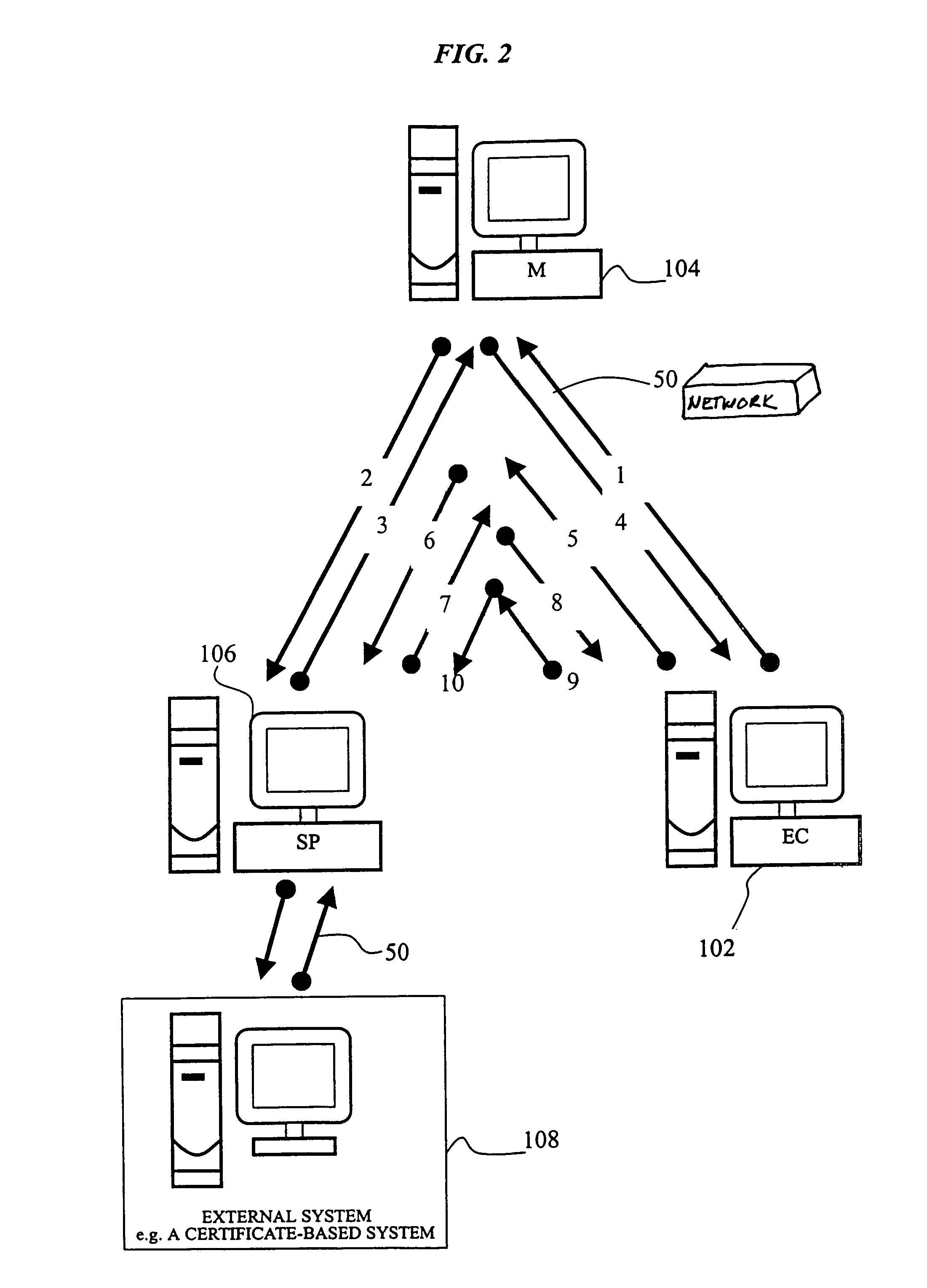

An electronic transaction system, which facilitates secure electronic transactions among multiple parties including cardholders, merchants, and service providers (SP). The system involves electronic cards, commonly known as smart cards, and their equivalent computer software package. The card mimics a real wallet and contains commonly seen financial or non-financial instruments such as a credit card, checkbook, or driver license. A transaction is protected by a hybrid key cryptographic system and is normally carried out on a public network such as the Internet. Digital signatures and challenges-responses are used to ensure integrity and authenticity. The card utilizes secret keys such as session keys assigned by service providers (SPs) to ensure privacy for each transaction. The SP is solely responsible for validating each participant's sensitive information and assigning session keys. The system does not seek to establish a trust relationship between two participants of a transaction. The only trust relationship needed in a transaction is the one that exists between individual participants and the SP. The trust relationship with a participant is established when the SP has received and validated certain established account information from that particular participant. To start a transaction with a selected SP, a participant must have the public key of the intended SP. Since the public key is openly available, its availability can be easily established by the cardholder. The SP also acts as a gateway for the participants when a transaction involves interaction with external systems.

Owner:CINGULAR WIRELESS II LLC

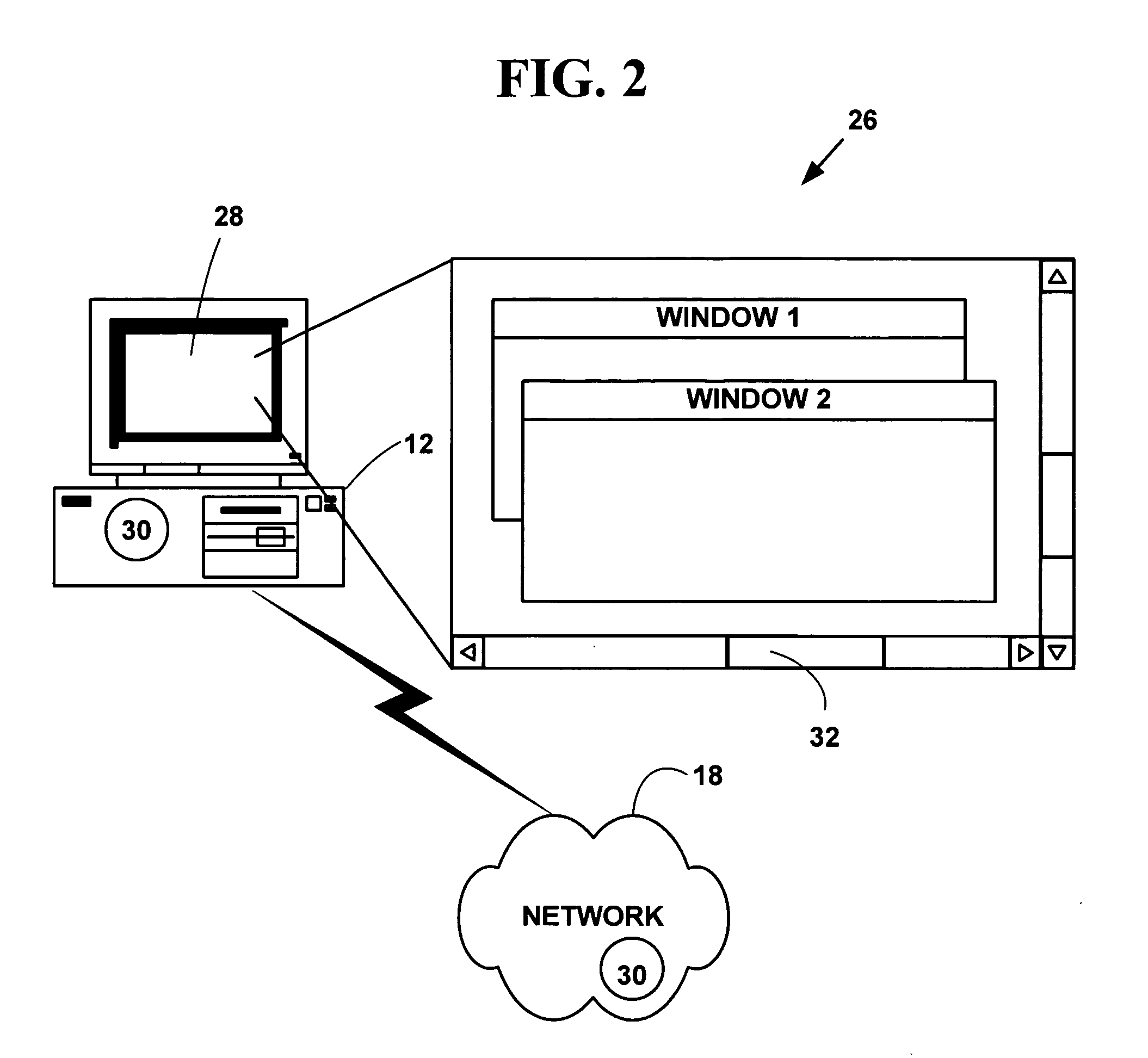

Method and system for providing a graphical user interface for electronic trading

A method and system for providing a graphical user interface for electronic trading. Electronic trading information is obtained on an application on a target device from one or more electronic trading exchanges. The trading electronic information is processed electronic trading information is displayed on a multi-windowed graphical user interface (GUI) where it is used to automatically executed automatic trades. The method and system may improve multiple types of electronic information that can be selectively displayed on a GUI by a user and used to automatically execute plural different pre-determined types of electronic trading strategies.

Owner:ROSENTHAL COLLINS GROUP

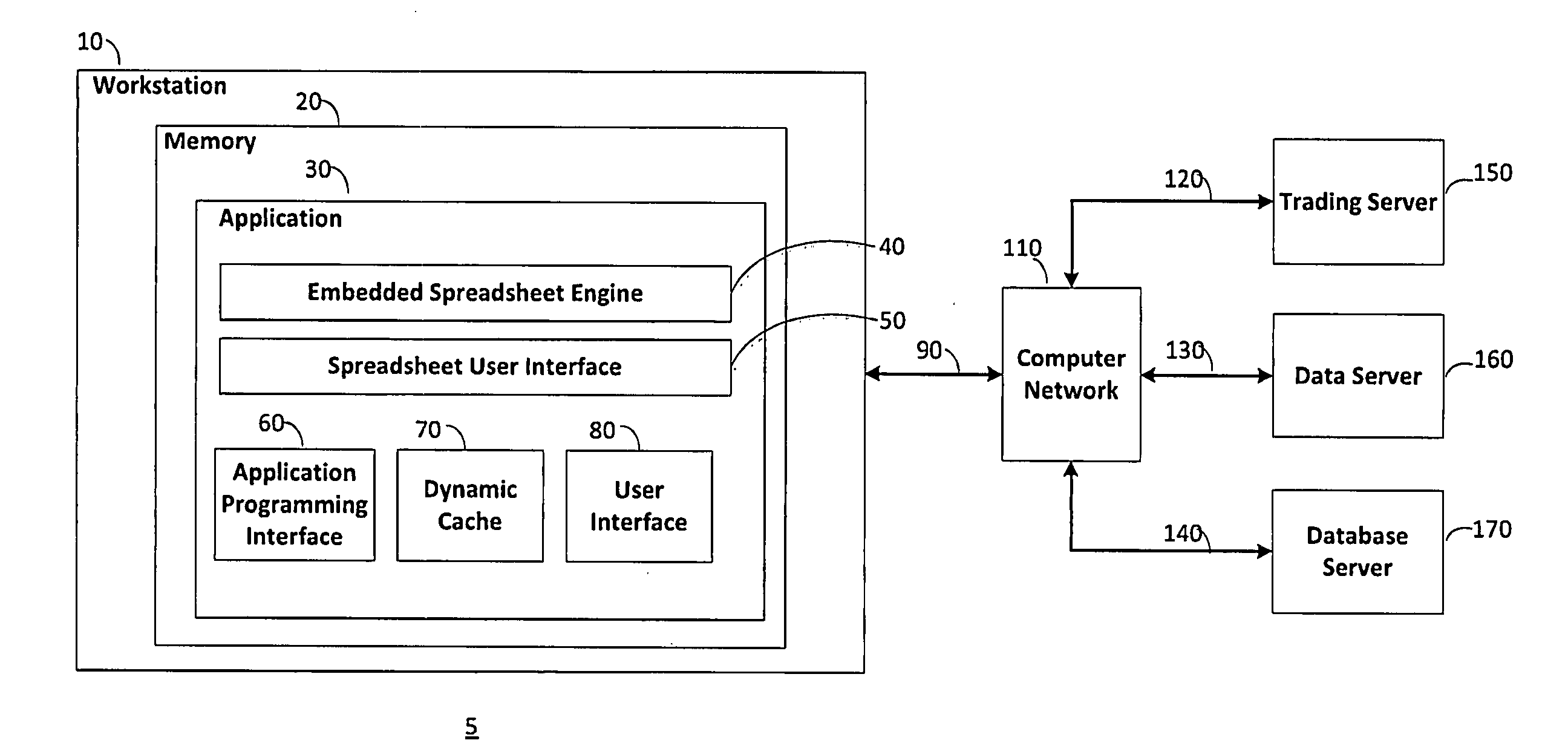

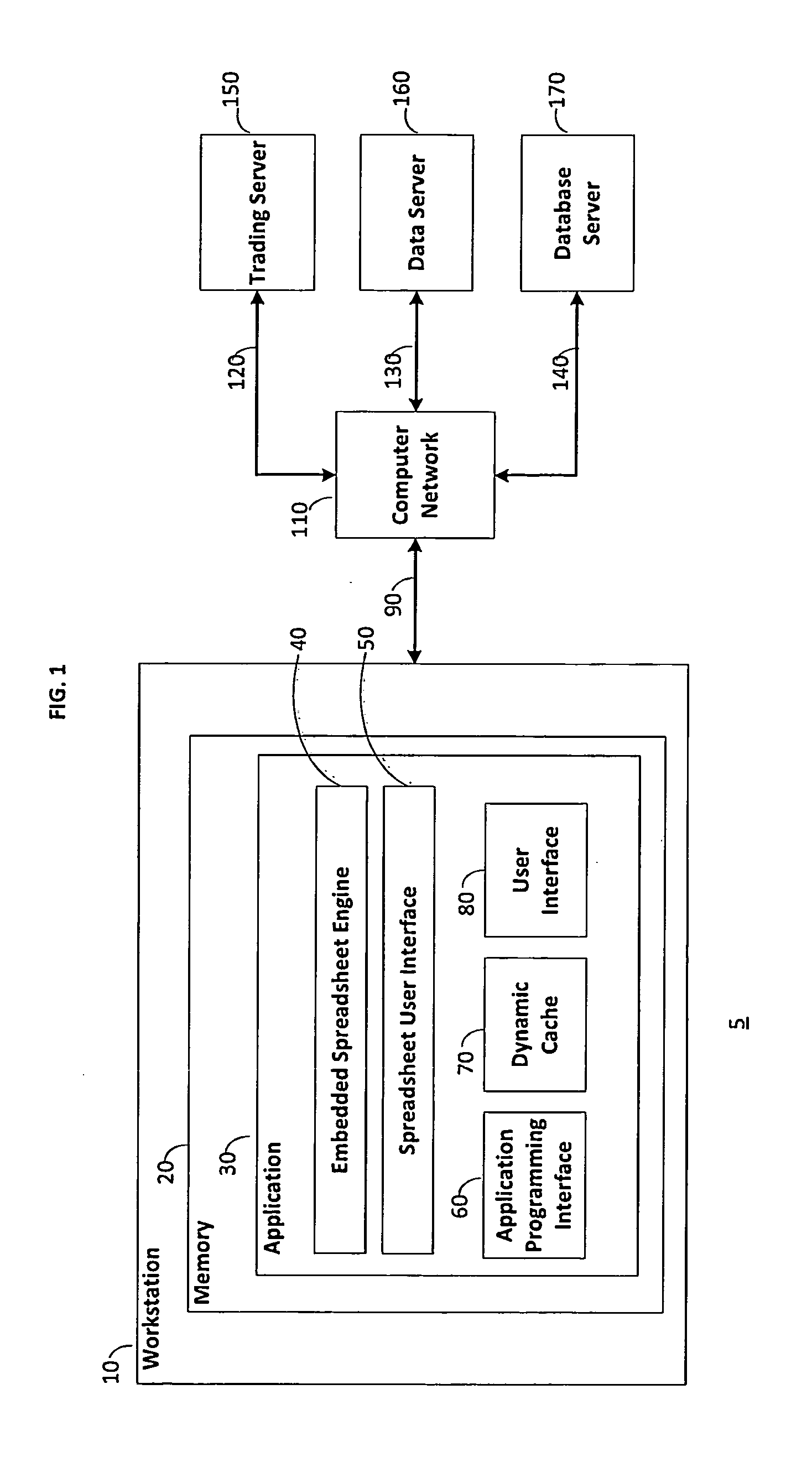

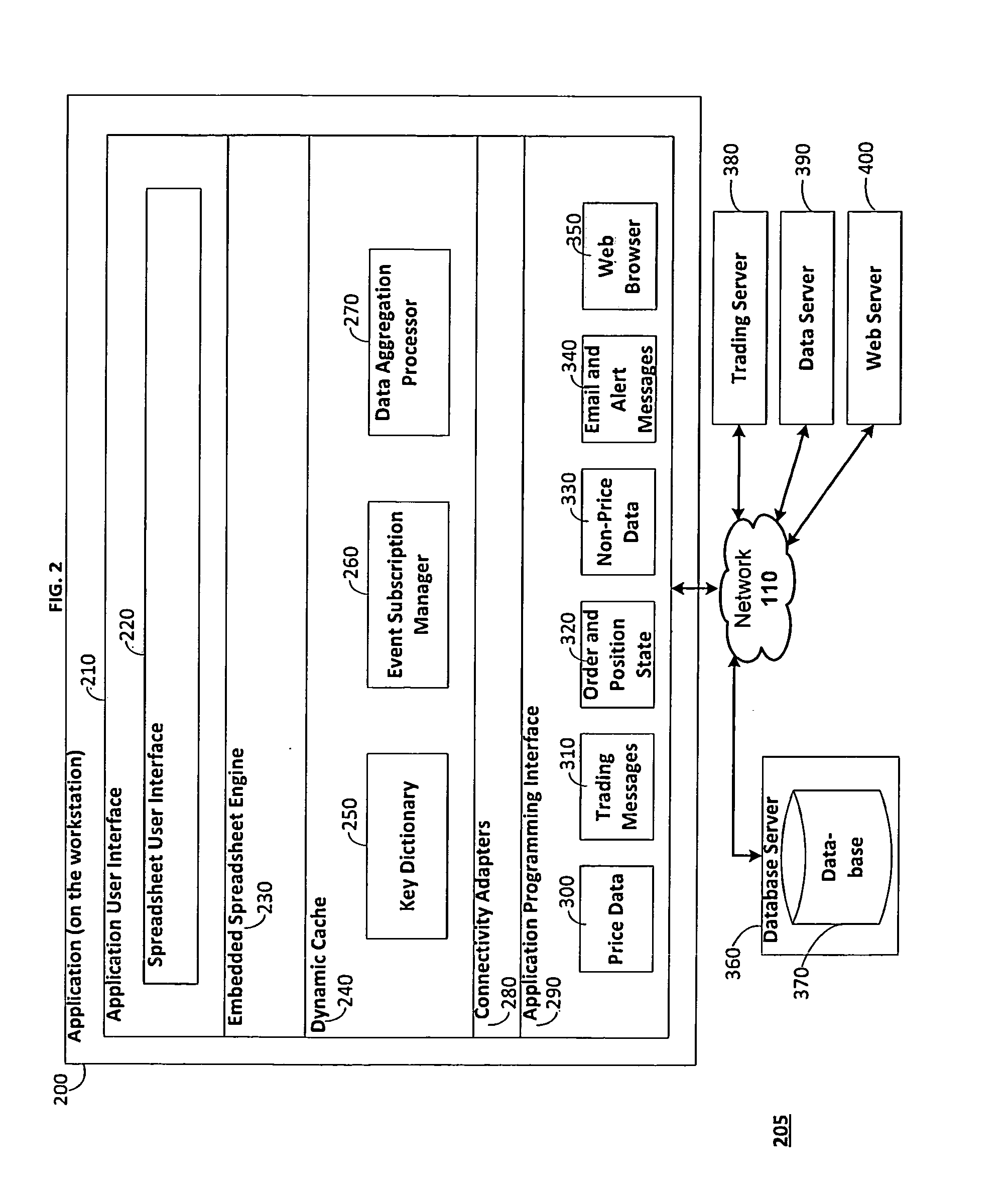

Systems and methods for trading using an embedded spreadsheet engine and user interface

Systems and methods for facilitating trading and trading analyses are presented herein. Aspects of the present invention include systems and methods for receiving real-time and historic data, caching and updating the data for access by an embedded spreadsheet engine with a spreadsheet user interface, processing the data using spreadsheet logic and functions, and generating electronic trading message orders. Embodiments of the present invention also support the publishing of and subscribing to data and trading messages. Embodiments of the present invention also support backtesting analyses.

Owner:BLACK POINT TECH

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com