Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

429 results about "Payment processor" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

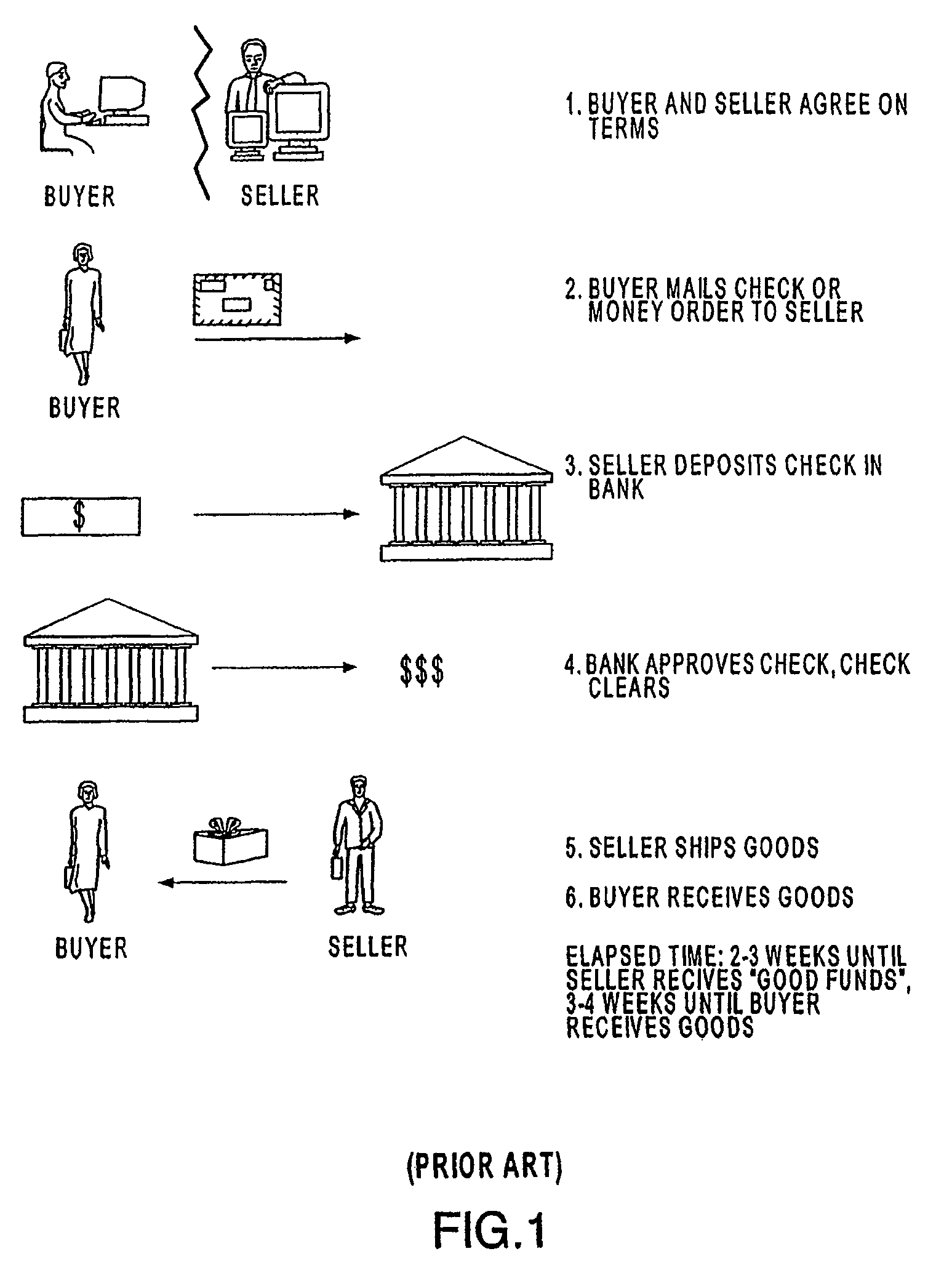

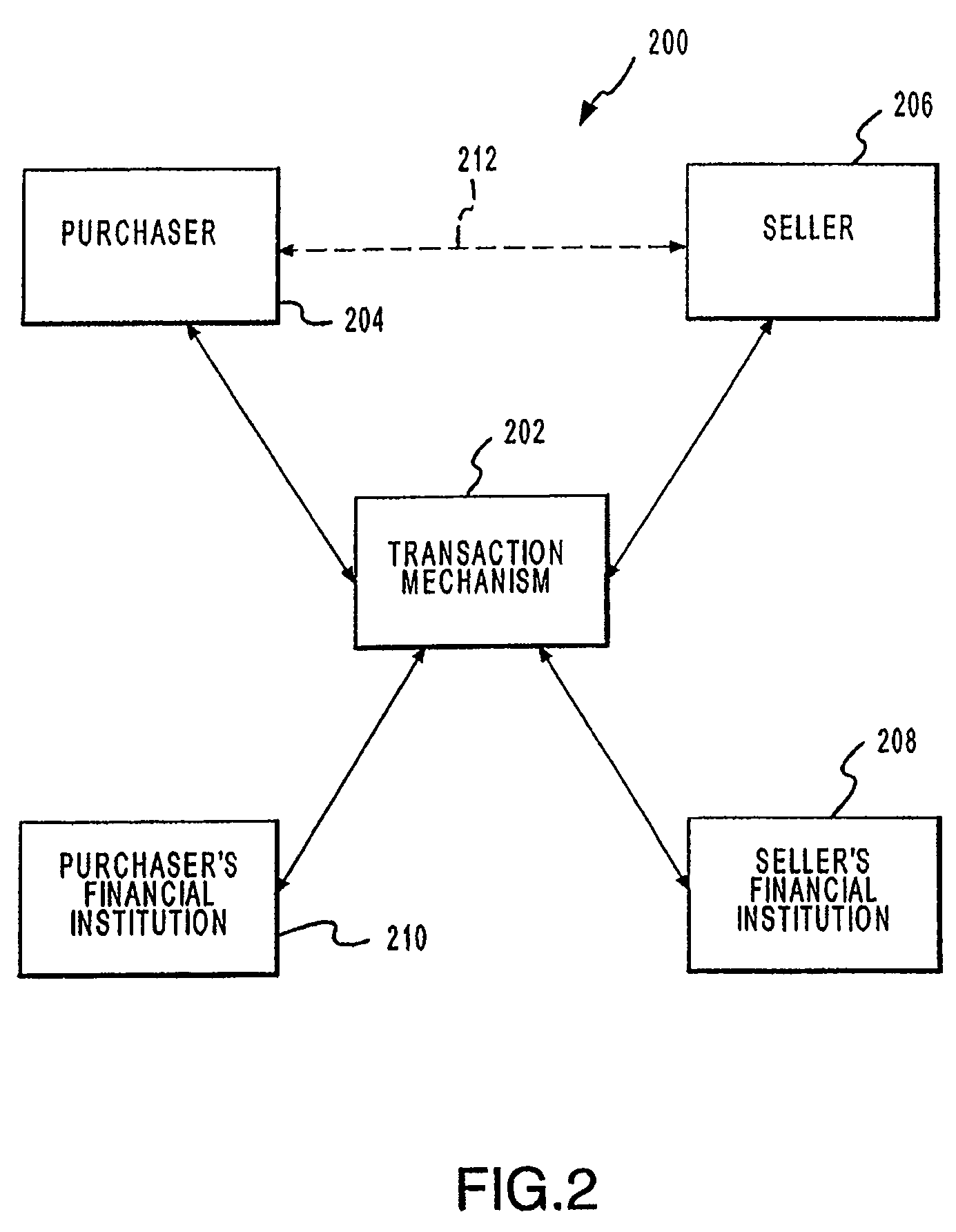

A payment processor is a company (often a third party) appointed by a merchant to handle transactions from various channels such as credit cards and debit cards for merchant acquiring banks. They are usually broken down into two types: front-end and back-end.

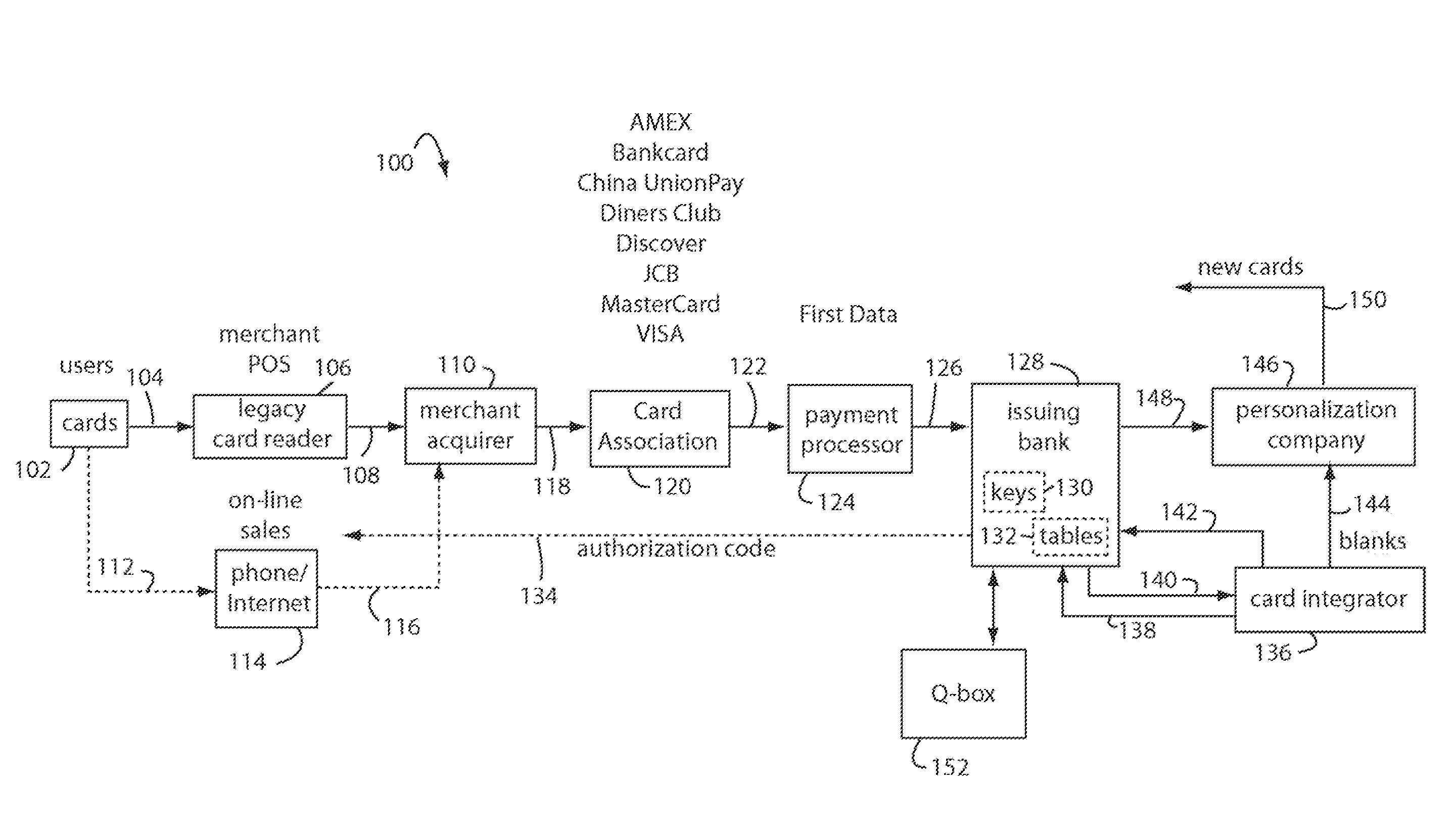

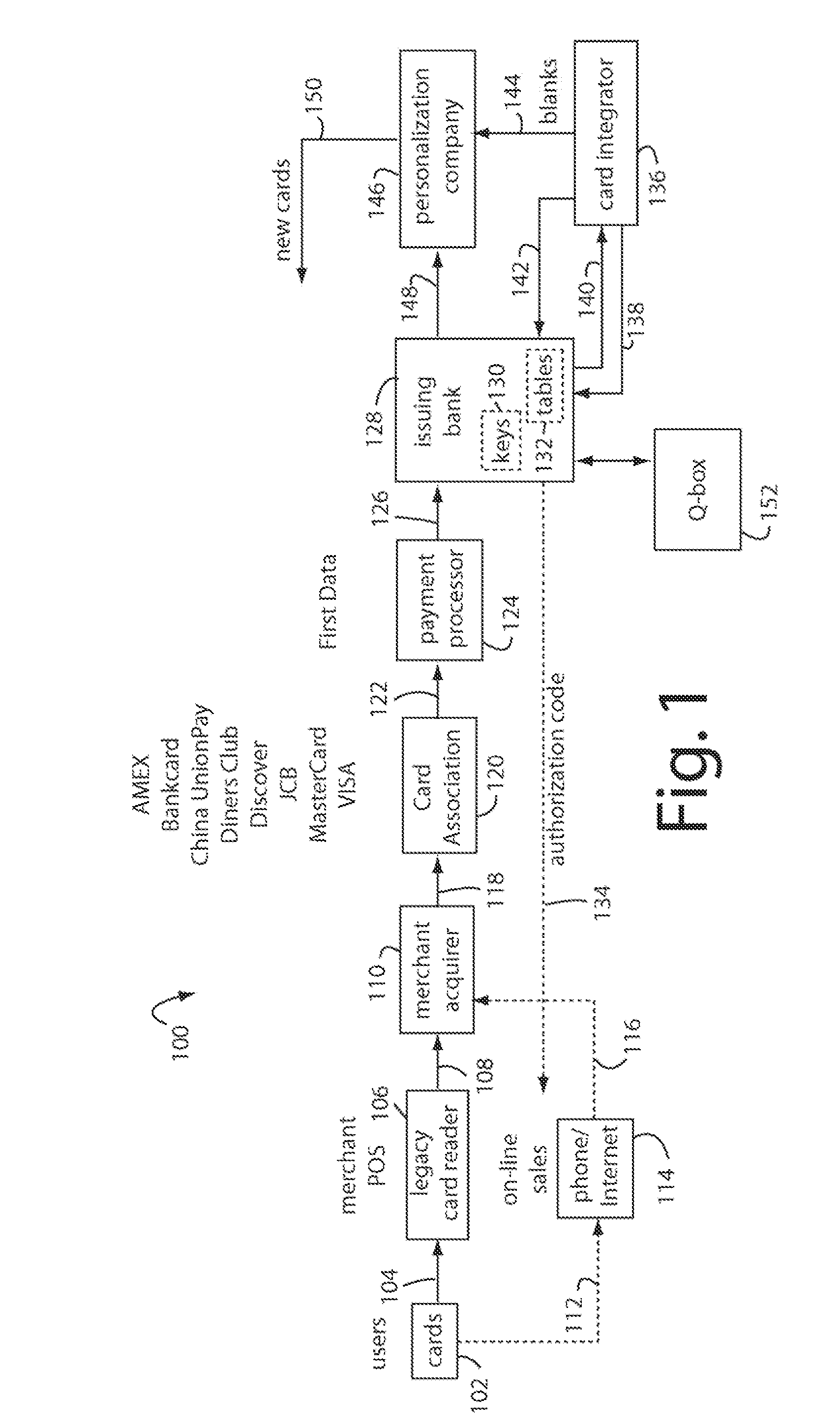

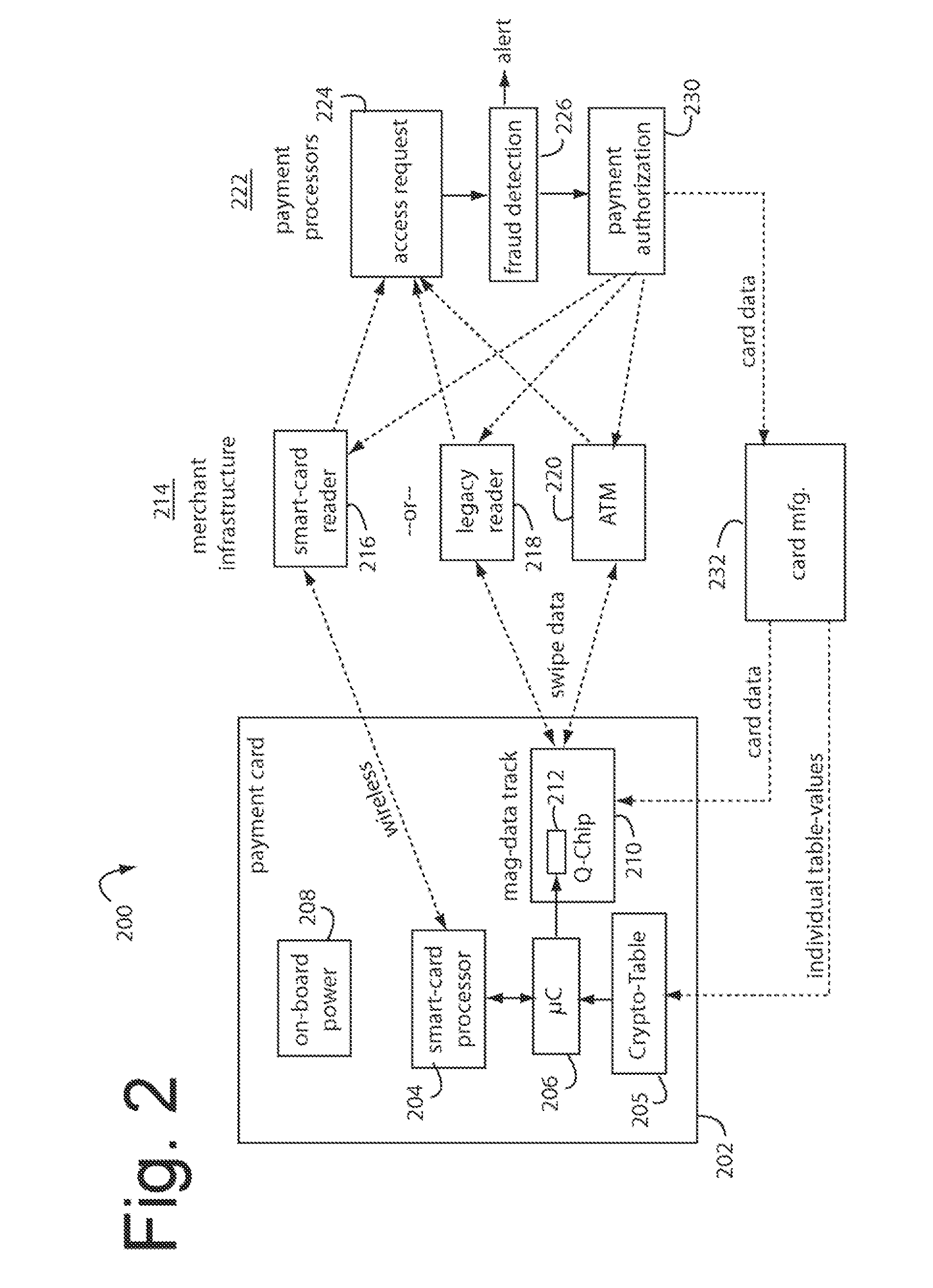

Financial transaction payment processor

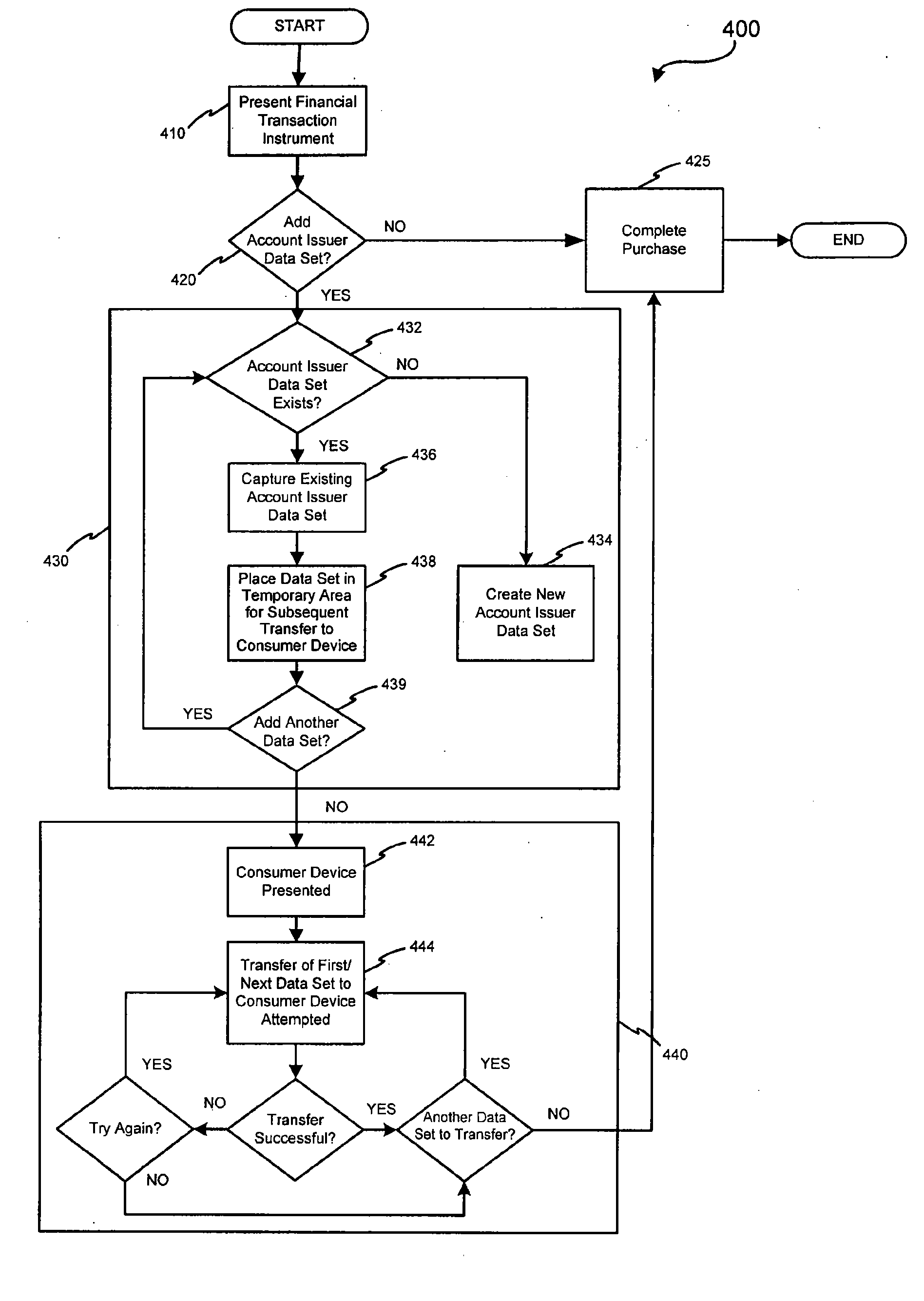

InactiveUS20090006262A1Sufficient dataAcutation objectsSynchronising transmission/receiving encryption devicesPayment orderFinancial transaction

A financial transaction payment processor includes an account access request processor for receiving dynamic swipe data from a payment card through a merchant infrastructure. A fraud detection processor is connected to analyze a dynamic data obtained by the account access request processor that should agree with values pre-loaded in a Crypto-Table by a card manufacturer. A payment authorization processor is connected to receive a message from the fraud detection processor and to then forward a response to the merchant infrastructure.

Owner:FITBIT INC

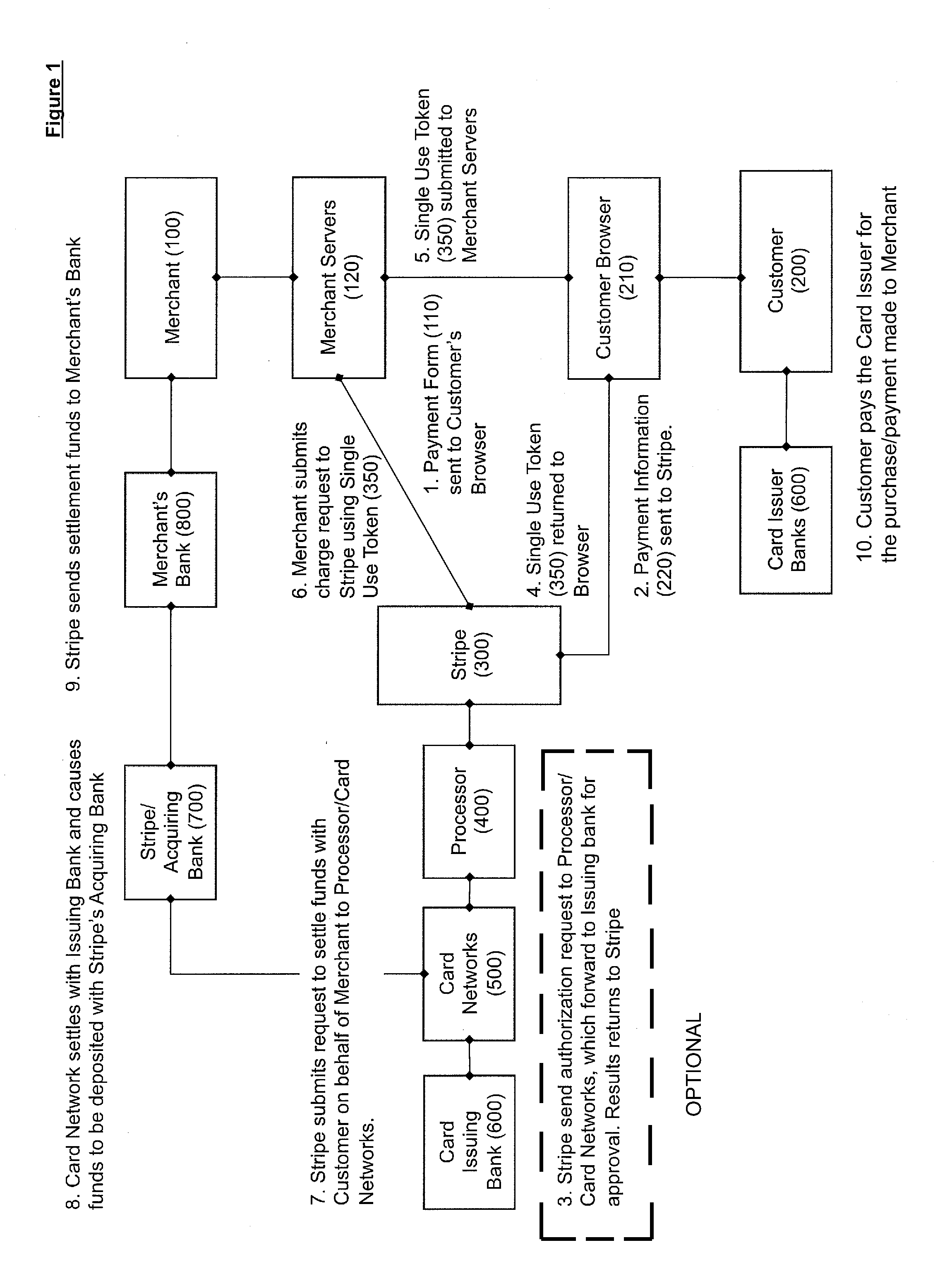

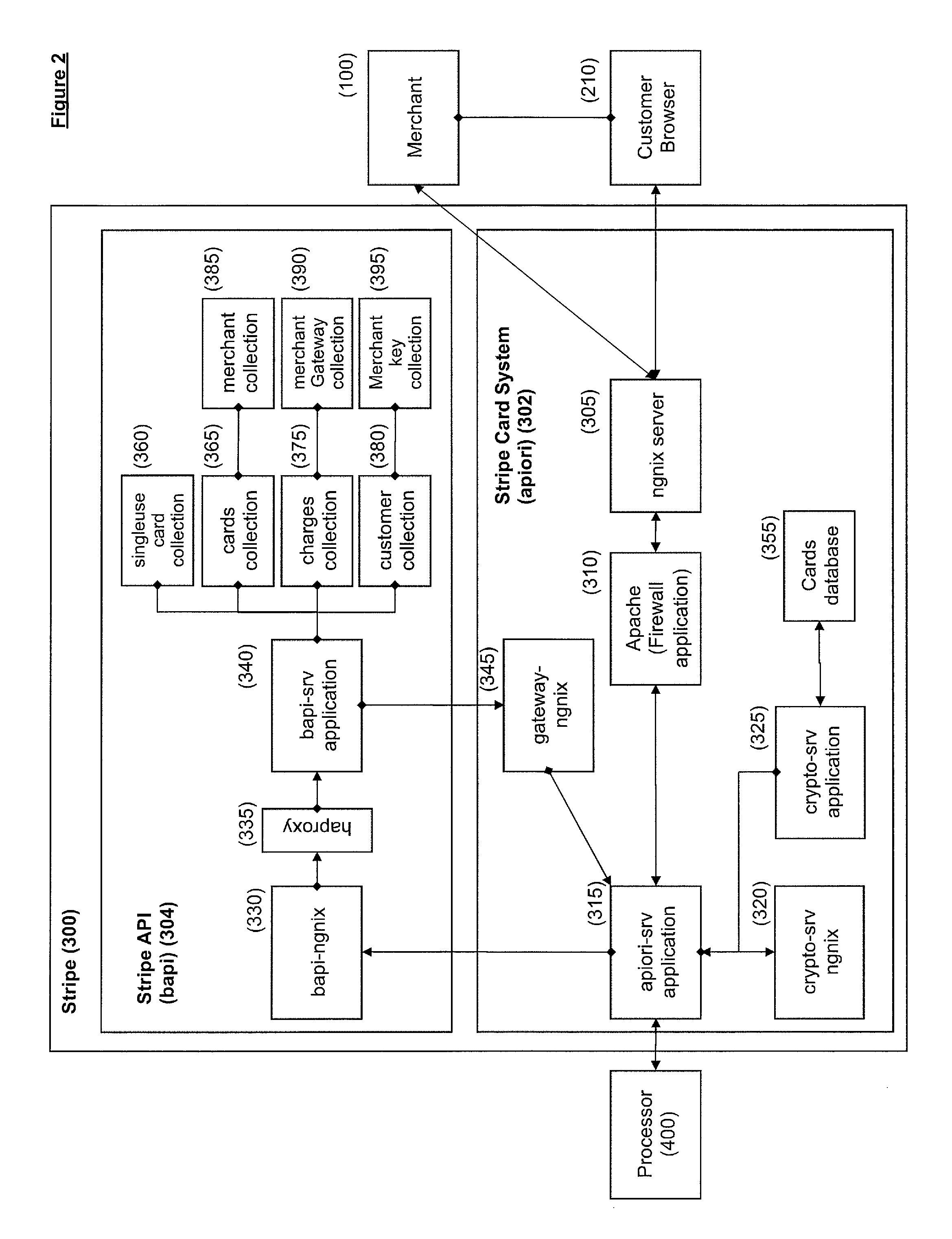

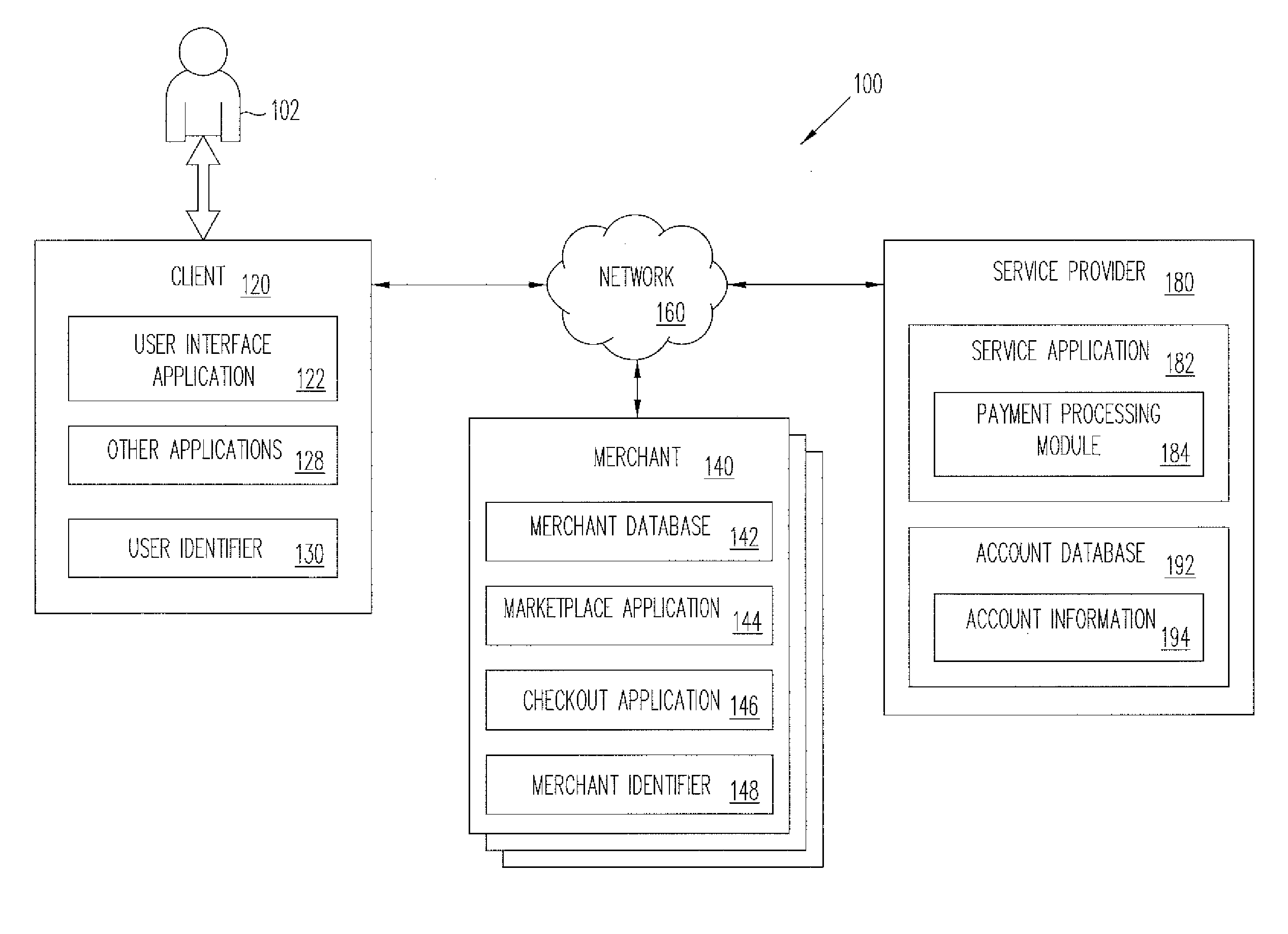

Method for conducting a transaction between a merchant site and a customer's electronic device without exposing payment information to a server-side application of the merchant site

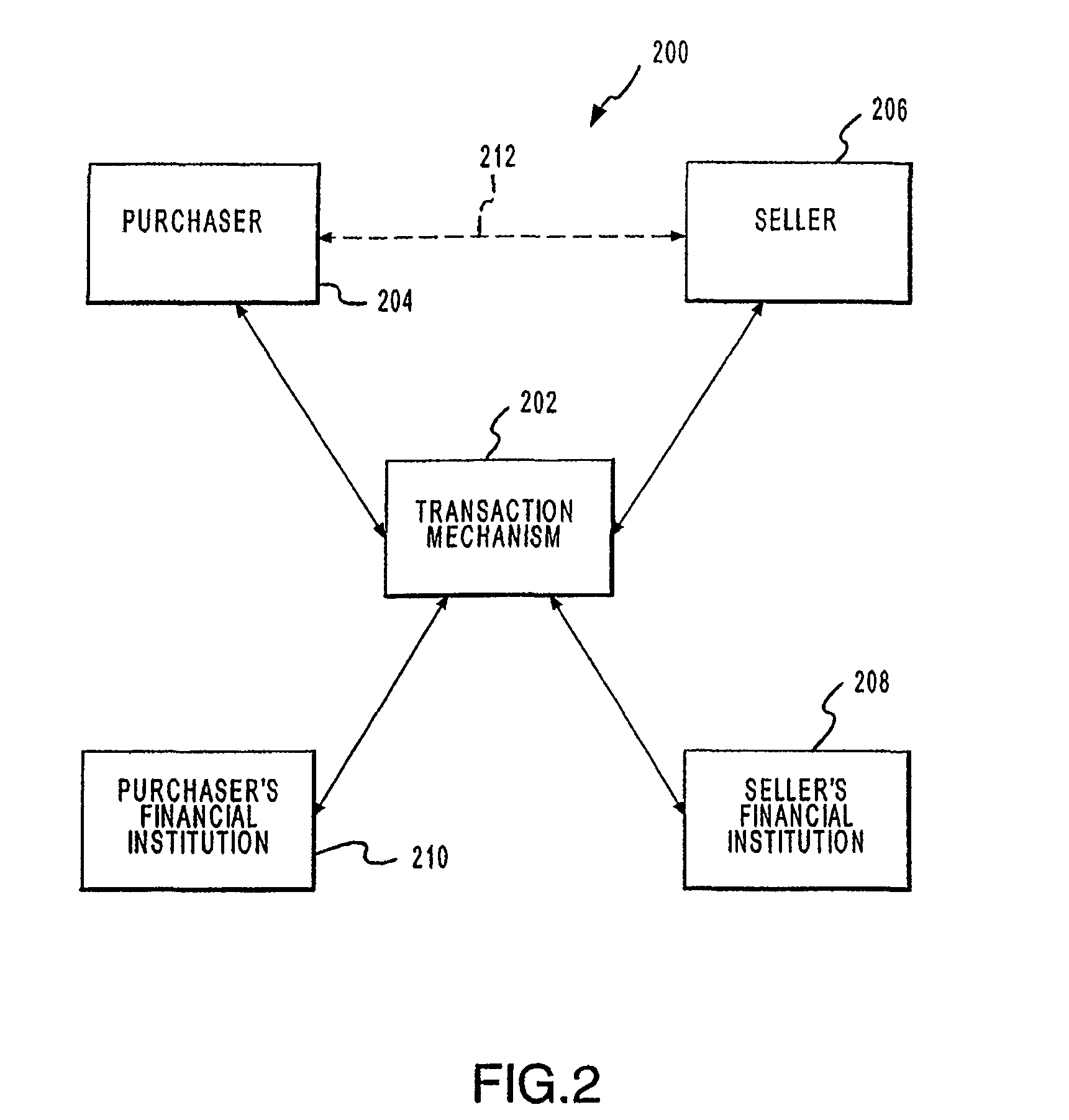

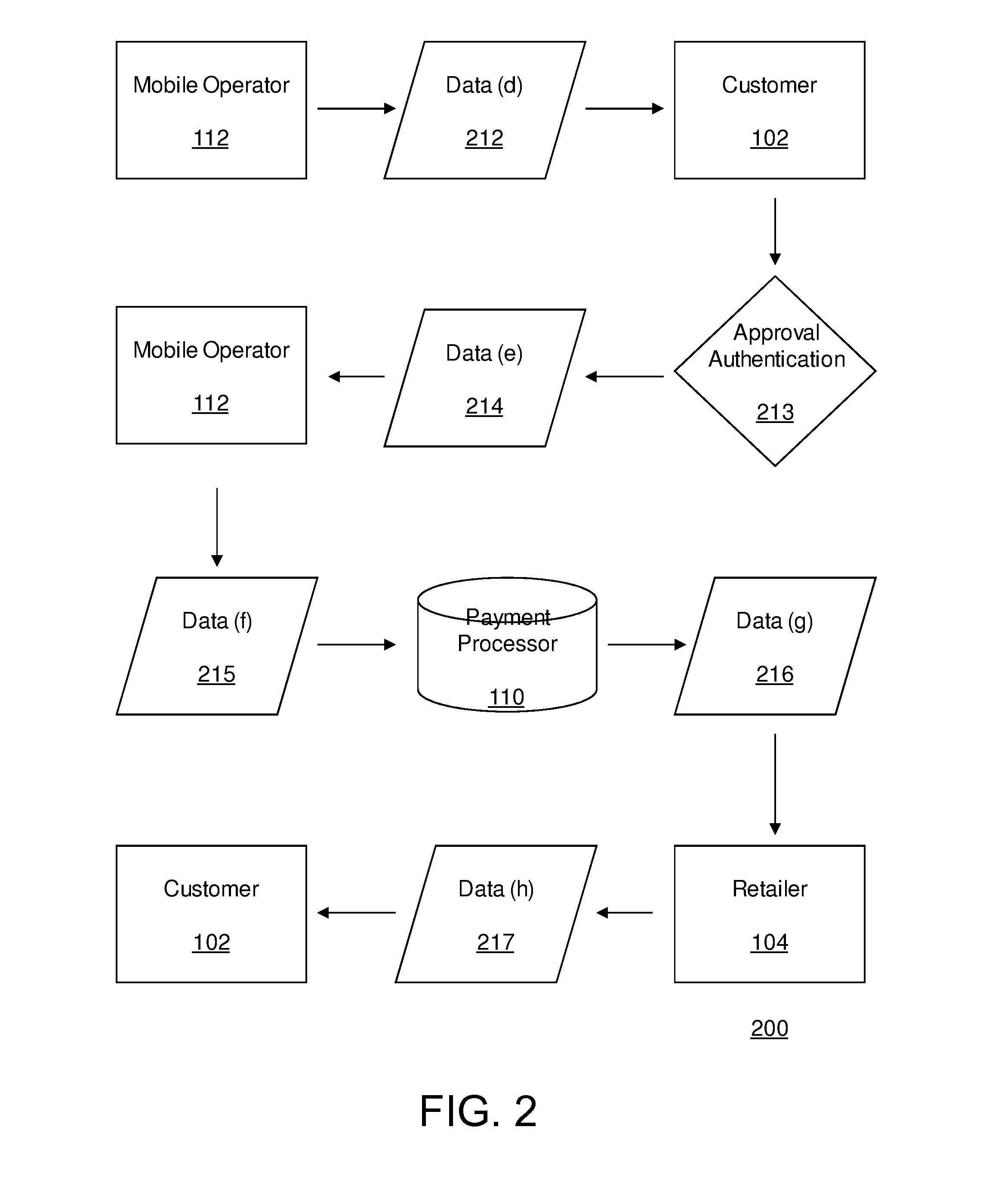

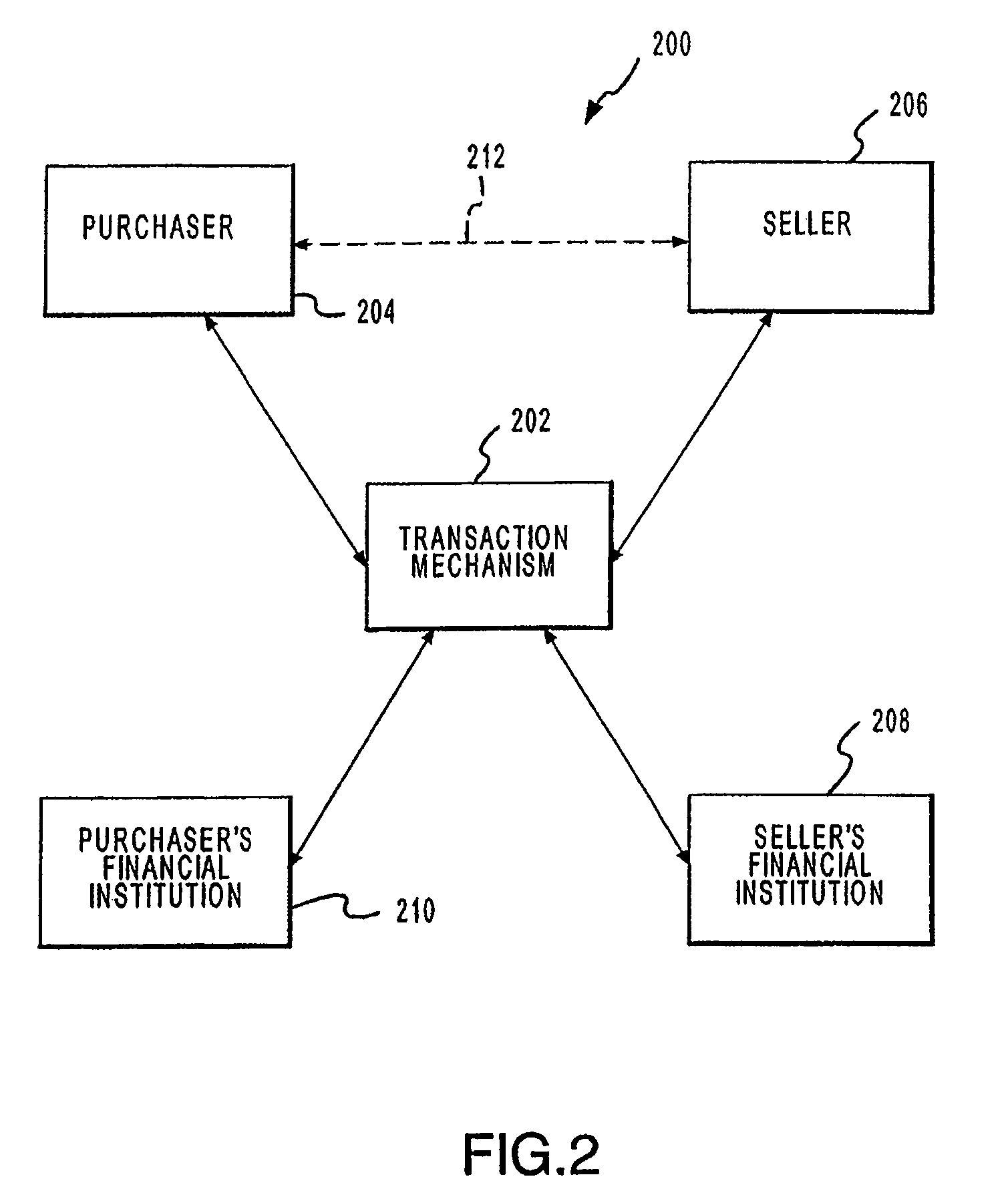

A transaction is conducted between a merchant site and a customer's electronic device using a payment processor. The merchant site is associated with a client-side application and a server-side application. The client-side application executes on the customer's electronic device. The client-side application electronically sends payment information retrieved from the customer's electronic device to the payment processor. The client-side application does not send the payment information to the server-side application. The payment processor creates a token from the payment information sent by the client-side application. The token functions as a proxy for the payment information. The payment processor electronically sends the token to the client-side application. The client-side application electronically sends the token to the server-side application for use by the server-side application in conducting the transaction. The payment information can thus be used by the server-side application via the token without the server-side application being exposed to the payment information.

Owner:STRIPE INC

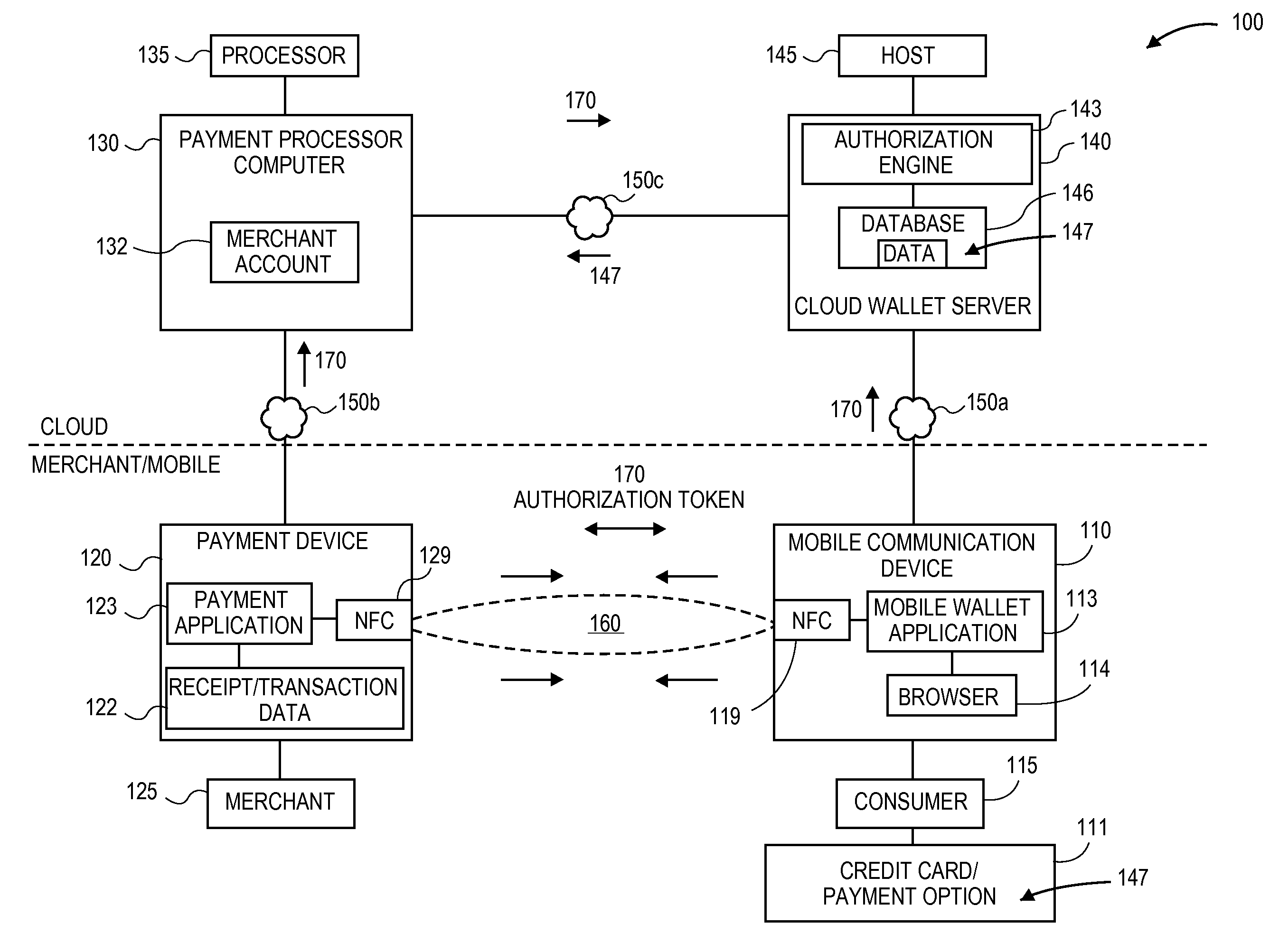

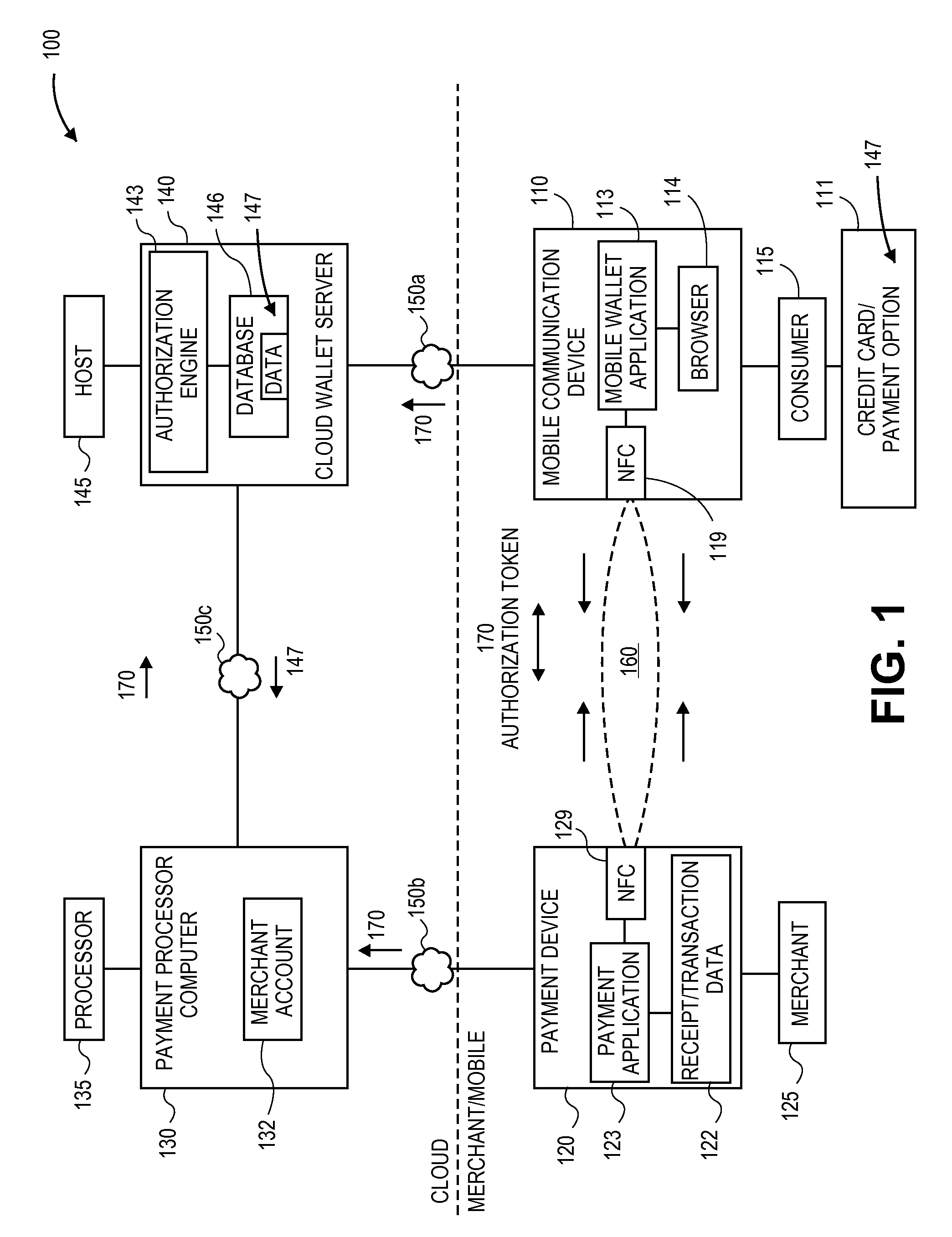

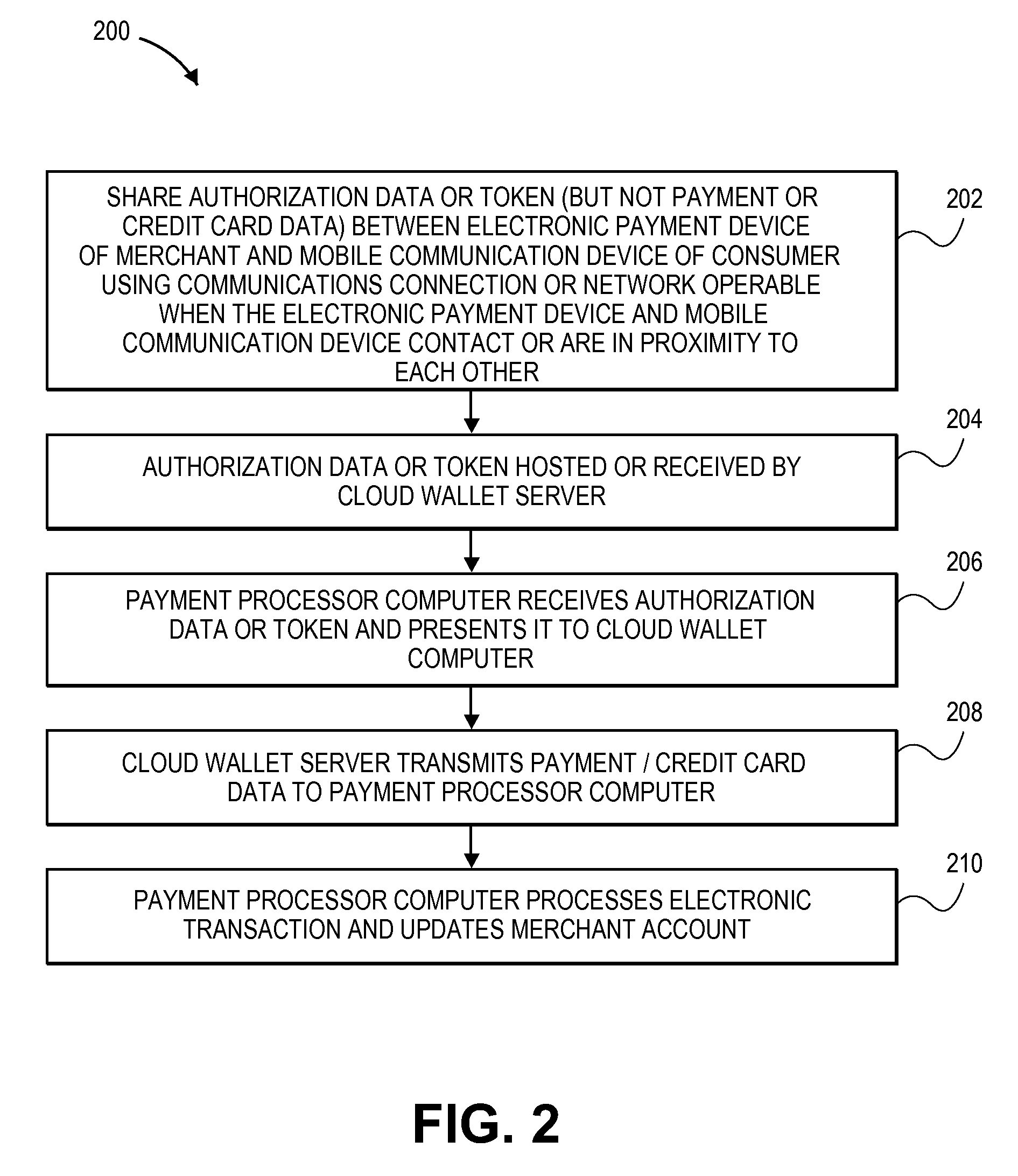

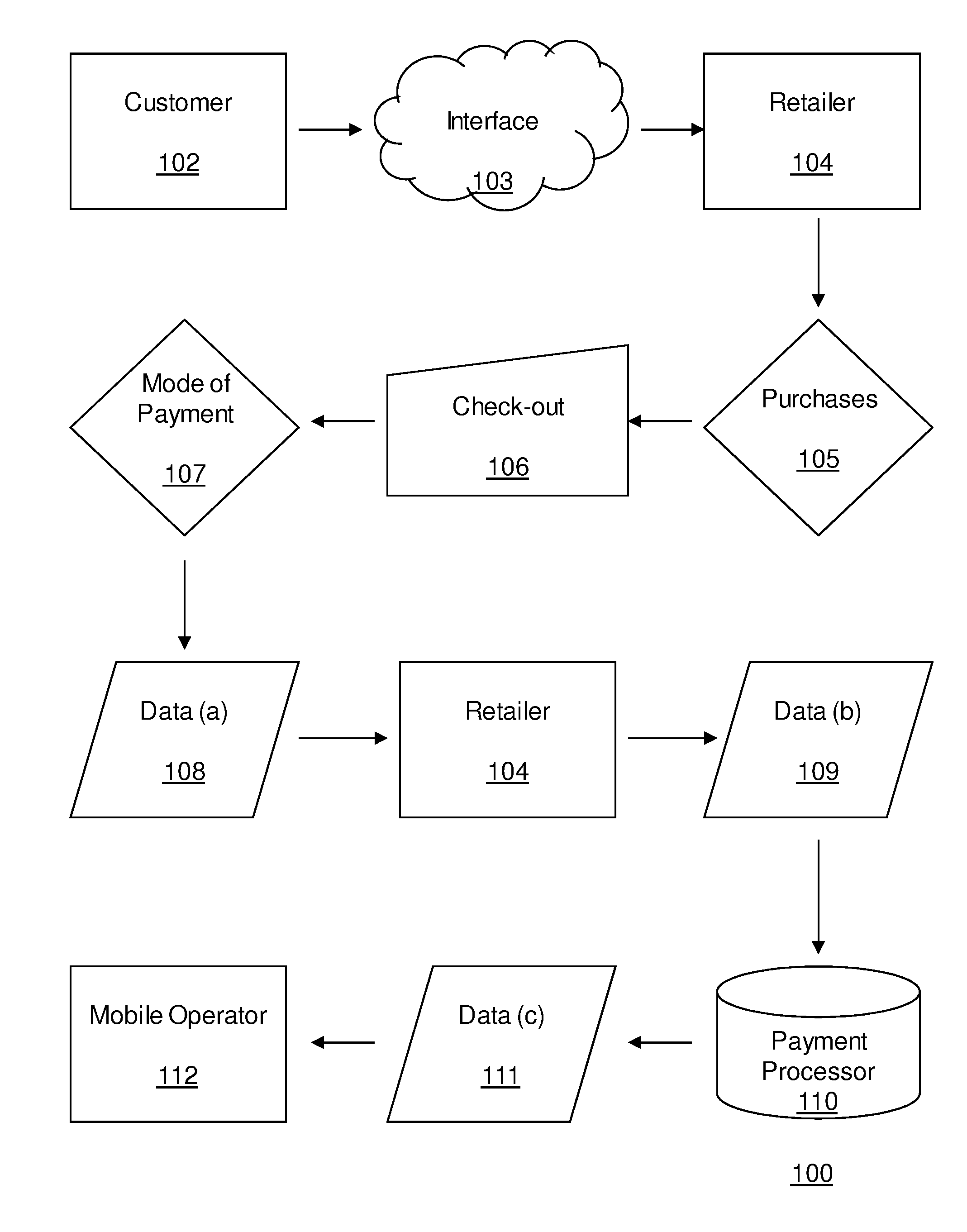

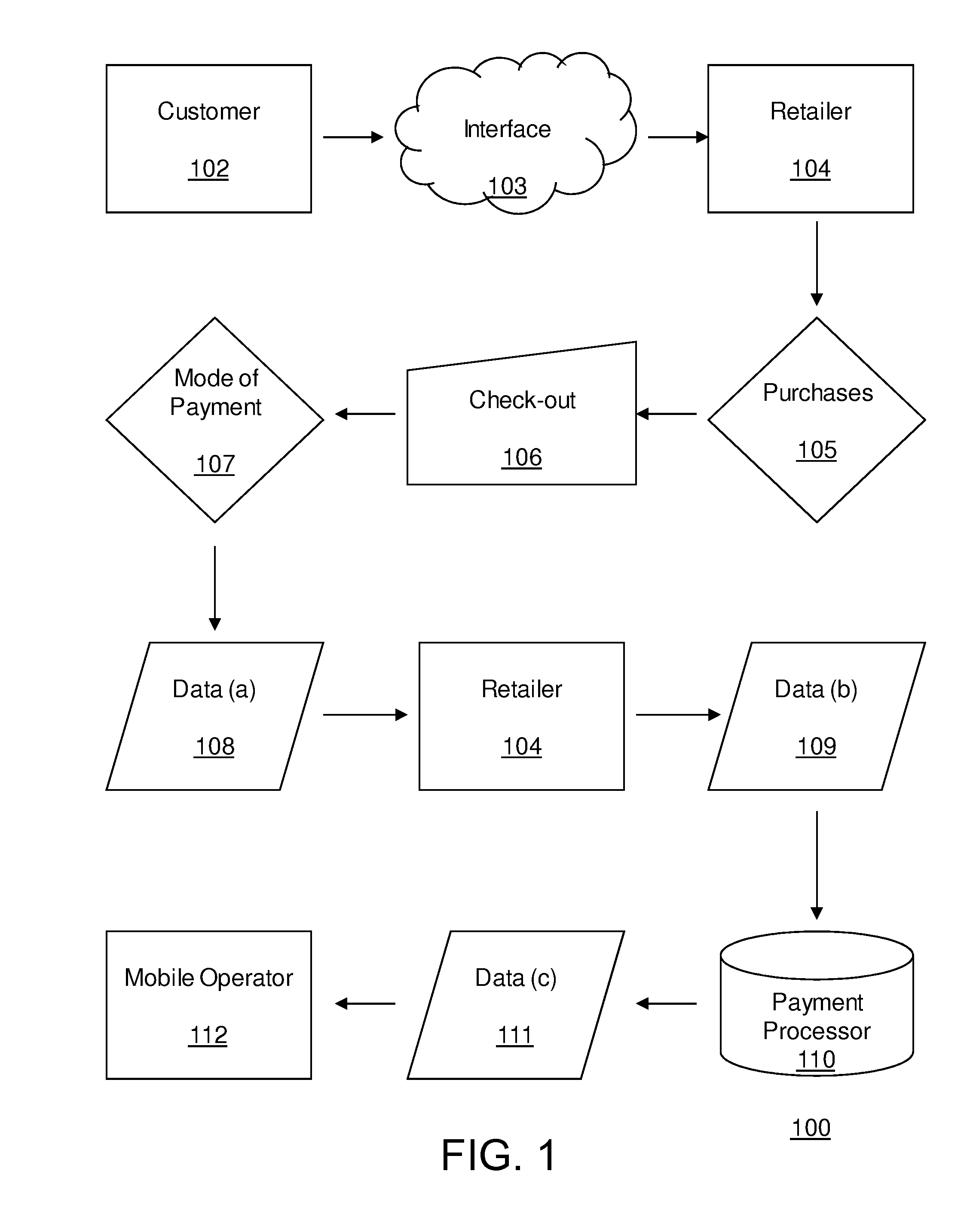

Processing electronic payment involving mobile communication device

ActiveUS20120290376A1The right amountPoint-of-sale network systemsCommerceComputer hardwareCredit card

Mobile payments and processing data related to electronic transactions. A near field communication connection is established between a mobile communication device of a consumer that serves as a mobile wallet and an electronic payment device of a merchant. Authorization data is shared between the mobile communication device and the electronic payment device without providing electronic payment instrument (e.g. credit card) data to the merchant. Authorization data is transmitted from the mobile communication device to a cloud computer or resource that serves as a cloud wallet and hosts respective data of respective electronic payment instruments of respective consumers, and from the electronic payment device a payment processor computer. The payment processor computer presents the authorization data to the cloud wallet, and in response, the cloud wallet transmits the credit card data to the payment processor computer, which processes the transaction.

Owner:INTUIT INC

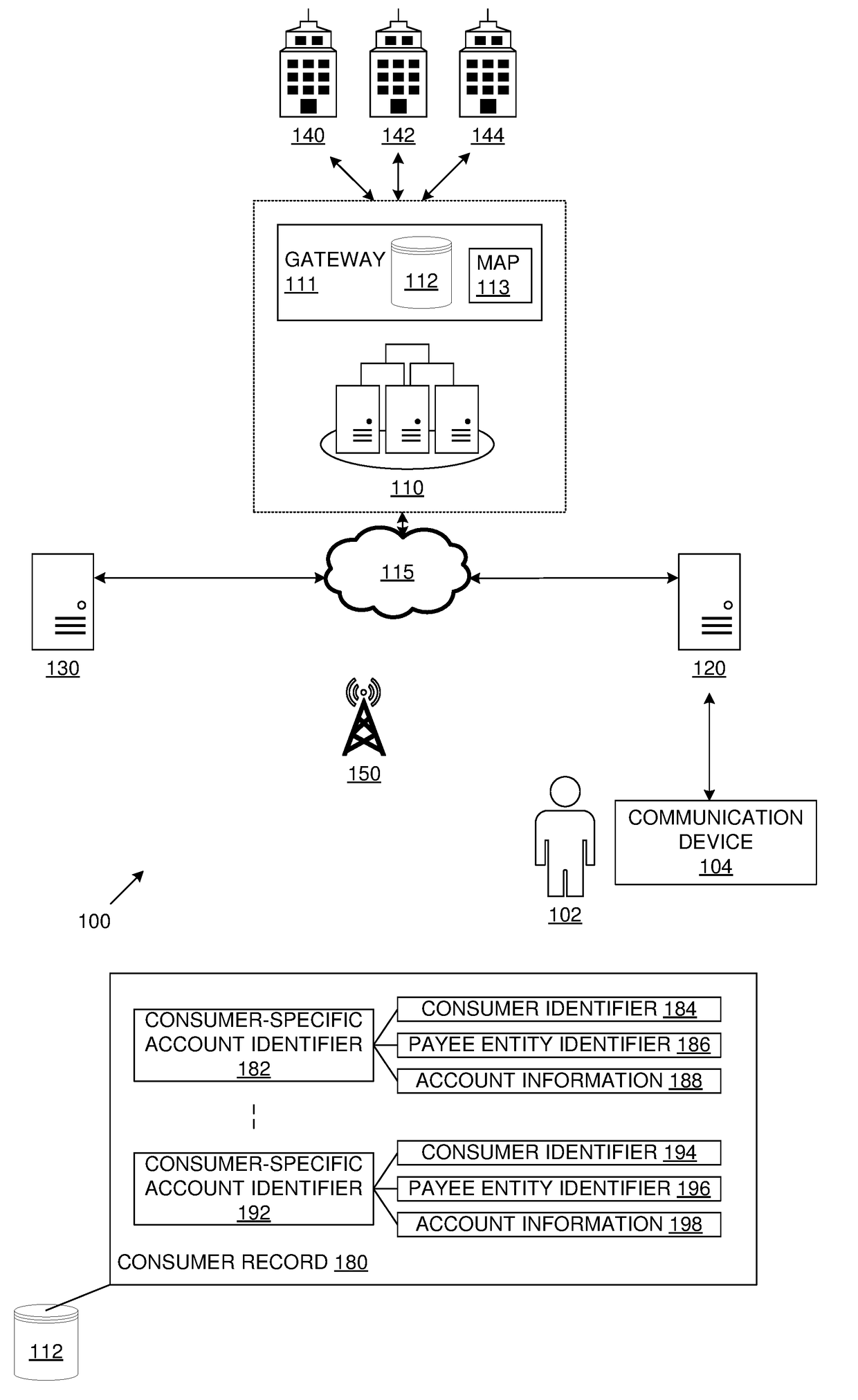

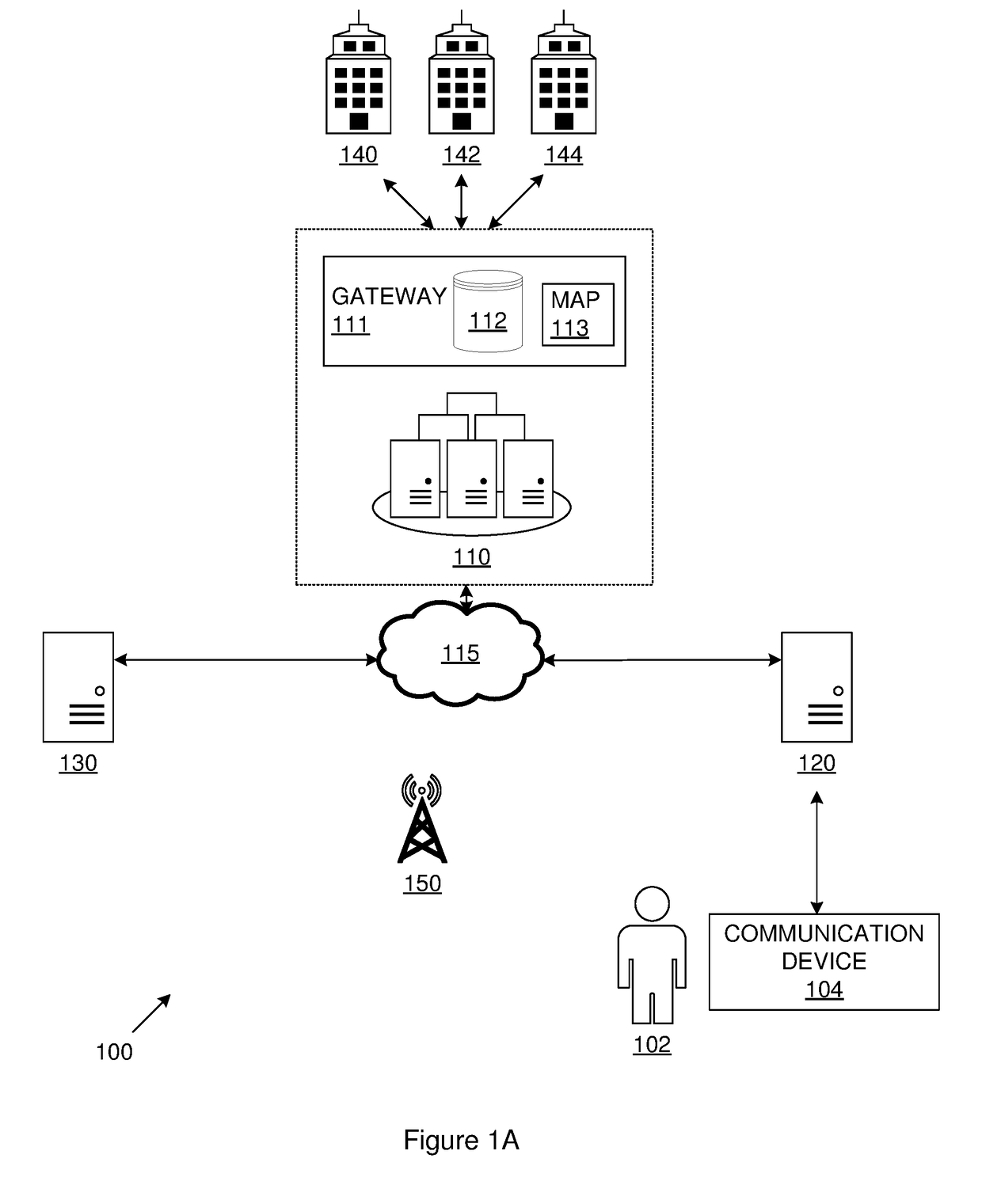

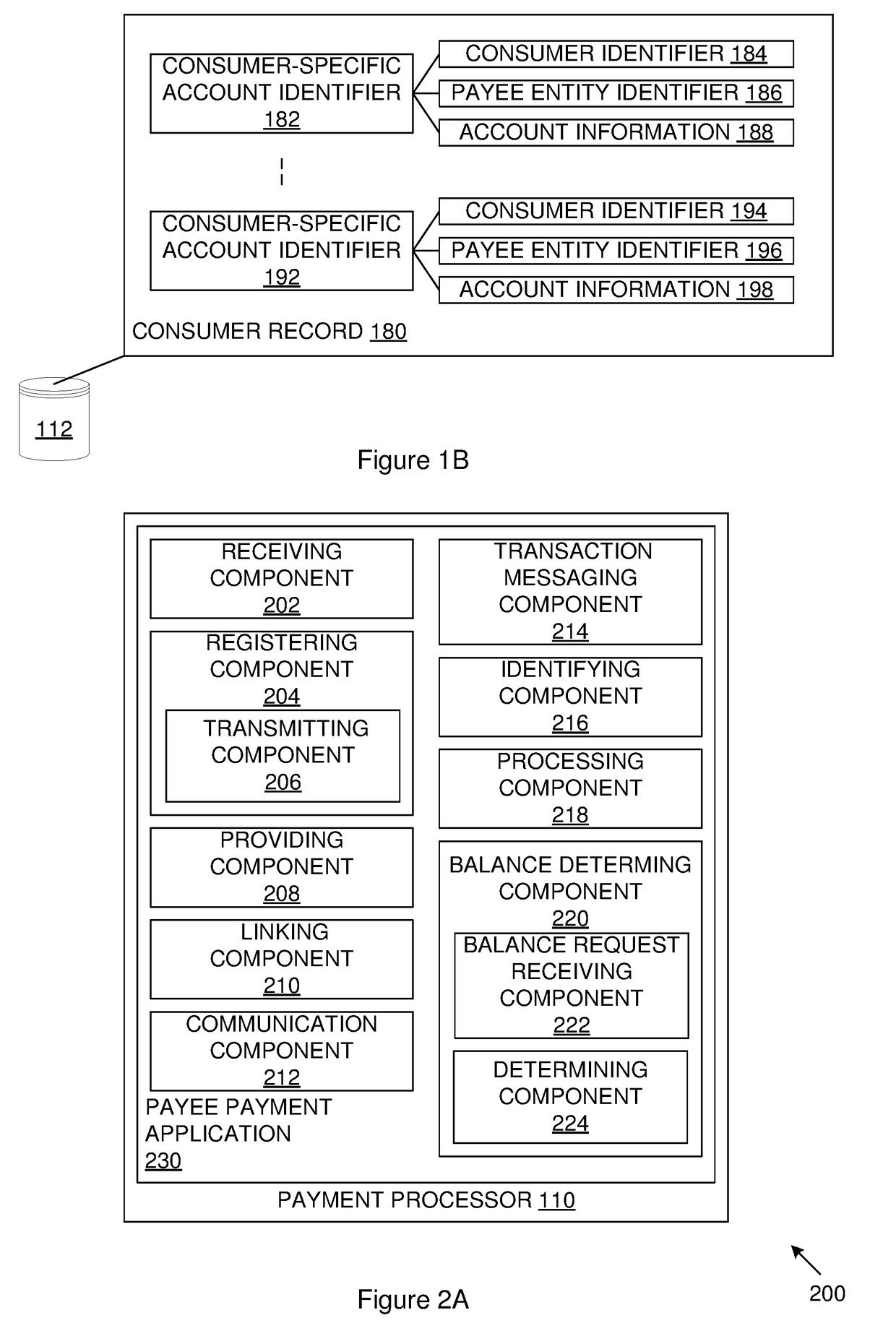

Systems and methods for initiating payments in favour of a payee entity

A system and method for initiating payments in favour of a payee entity are provided. In a method conducted at a payment processor, an account creation request, the request including an identifier of a consumer is received from a payee entity. A financial account is registered for the payee entity in association with the consumer identifier and a consumer-specific account identifier of the financial account is provided. The consumer-specific account identifier is linked to the payee entity and consumer identifier and transmitted to a communication device of the consumer directly or via the payee entity so as to permit the consumer to initiate a payment in favour of the financial account of the payee entity by generating a transaction request message including the consumer-specific account identifier.

Owner:VISA INT SERVICE ASSOC

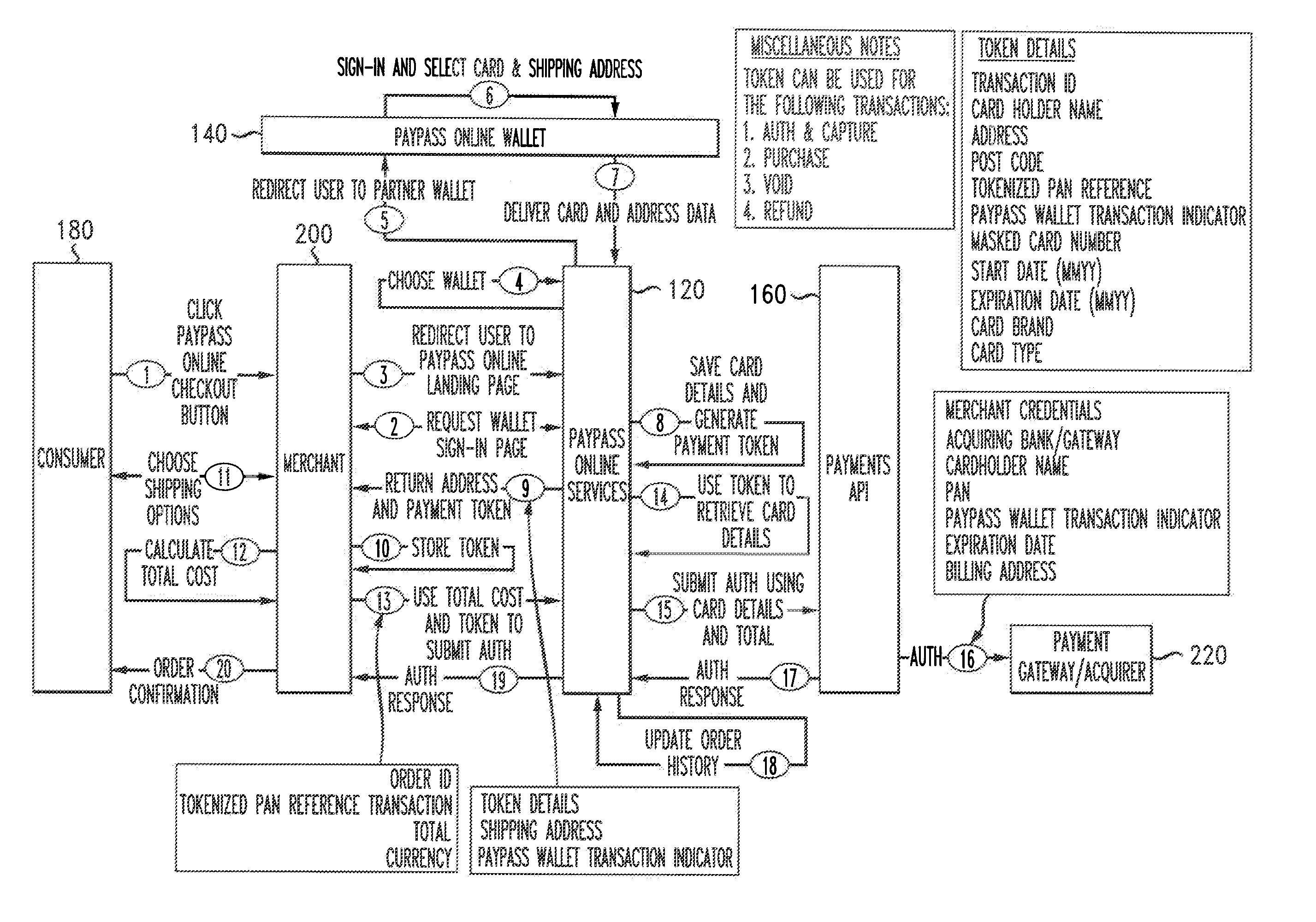

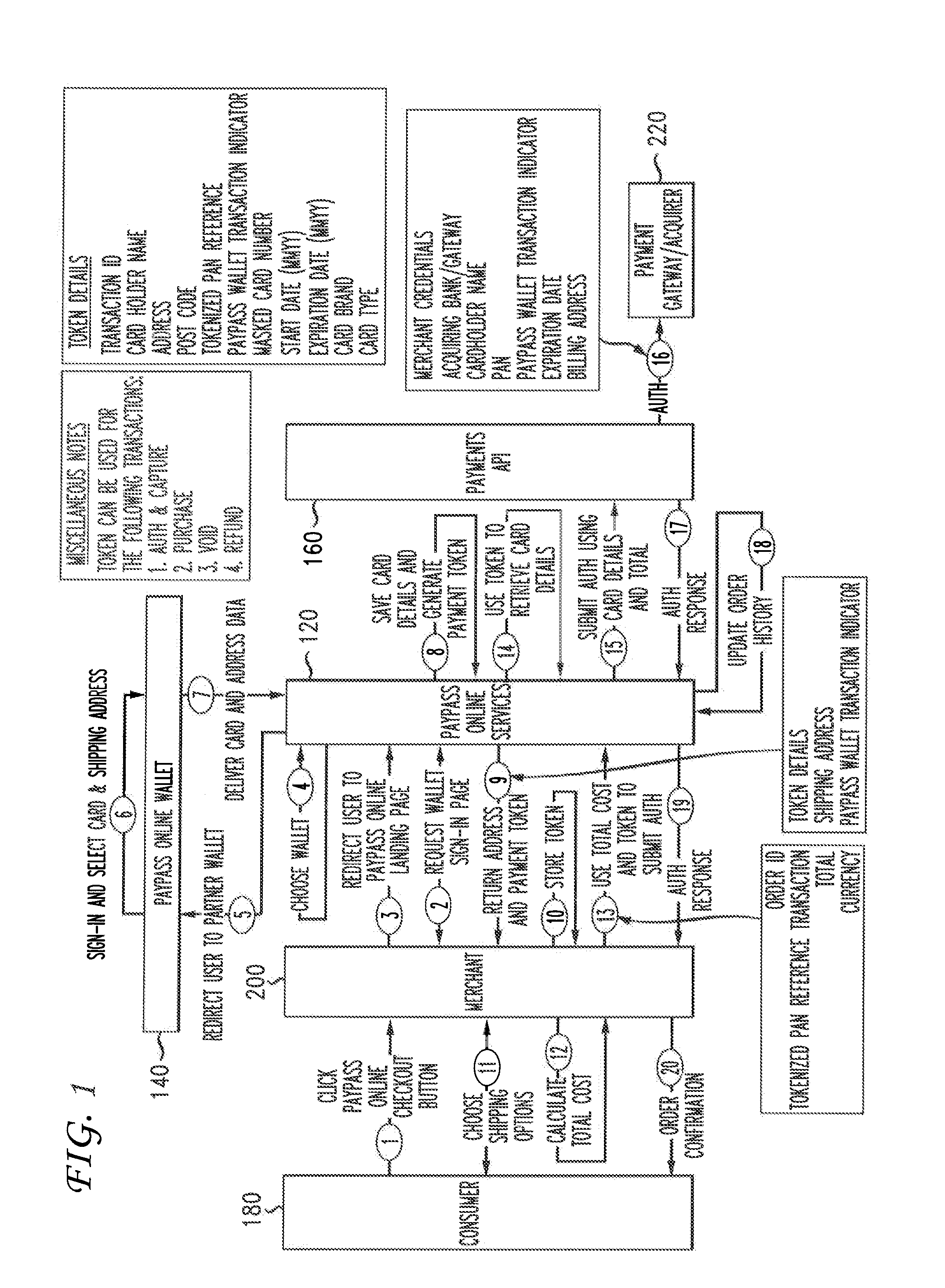

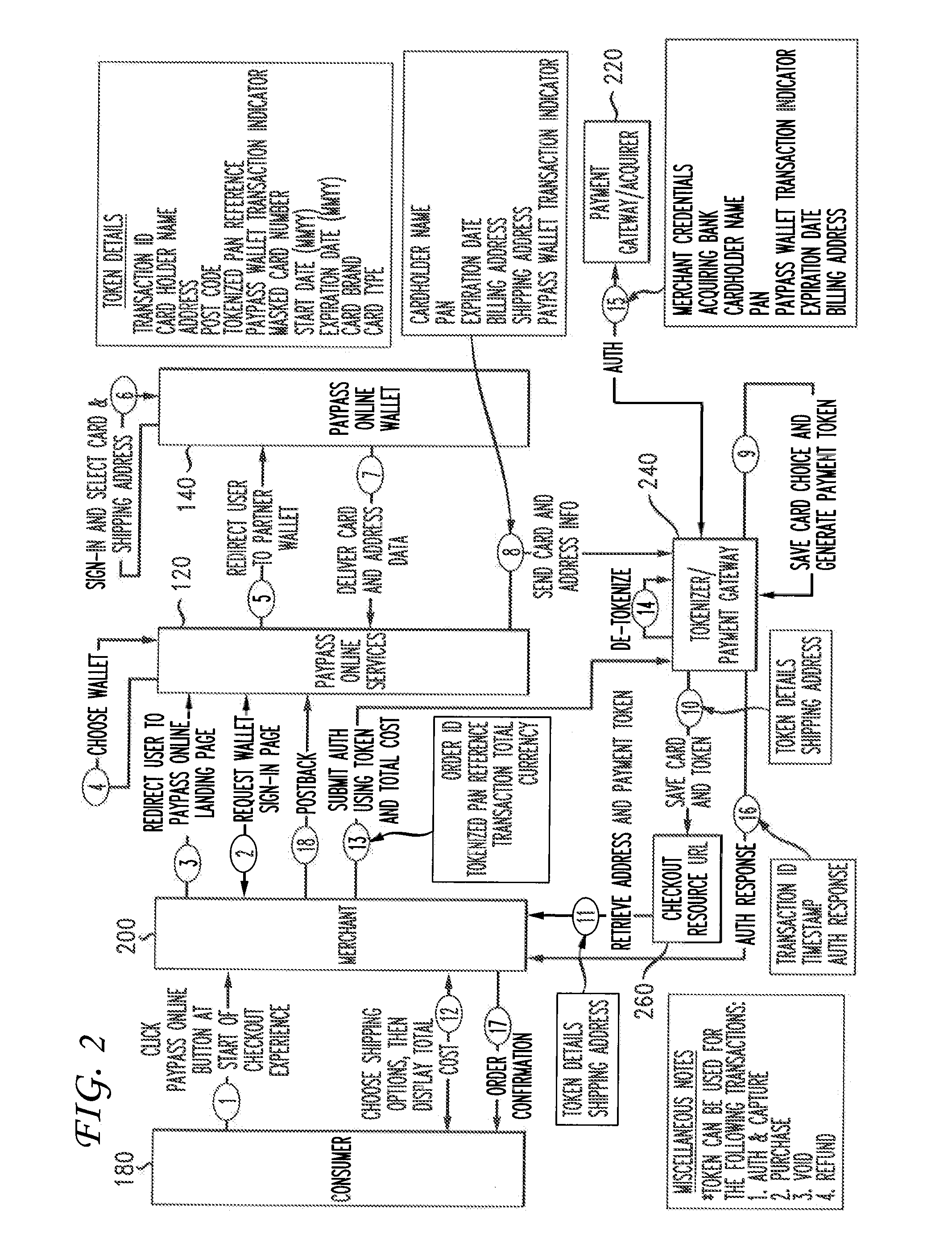

Transaction data tokenization

A system and method of tokenizing sensitive cardholder payment information for use in cashless transactions includes receiving a request to process a cashless transaction between a merchant and a purchaser using first payment data stored with an electronic wallet provider on behalf of the purchaser. First payment data is retrieved from the electronic wallet provider. The first payment data is tokenized into a payment token, and provided to the merchant for use in completing the cashless transaction. The merchant issues a request to process payment for the cashless transaction using the payment token. The payment token is detokenized into second payment data, with correspondence between the first and second payment data being indicative of payment token authenticity. Payment for the cashless transaction is processed using the second payment data, and the merchant is provided with a response indicating either the success or failure of the payment processing.

Owner:MASTERCARD INT INC

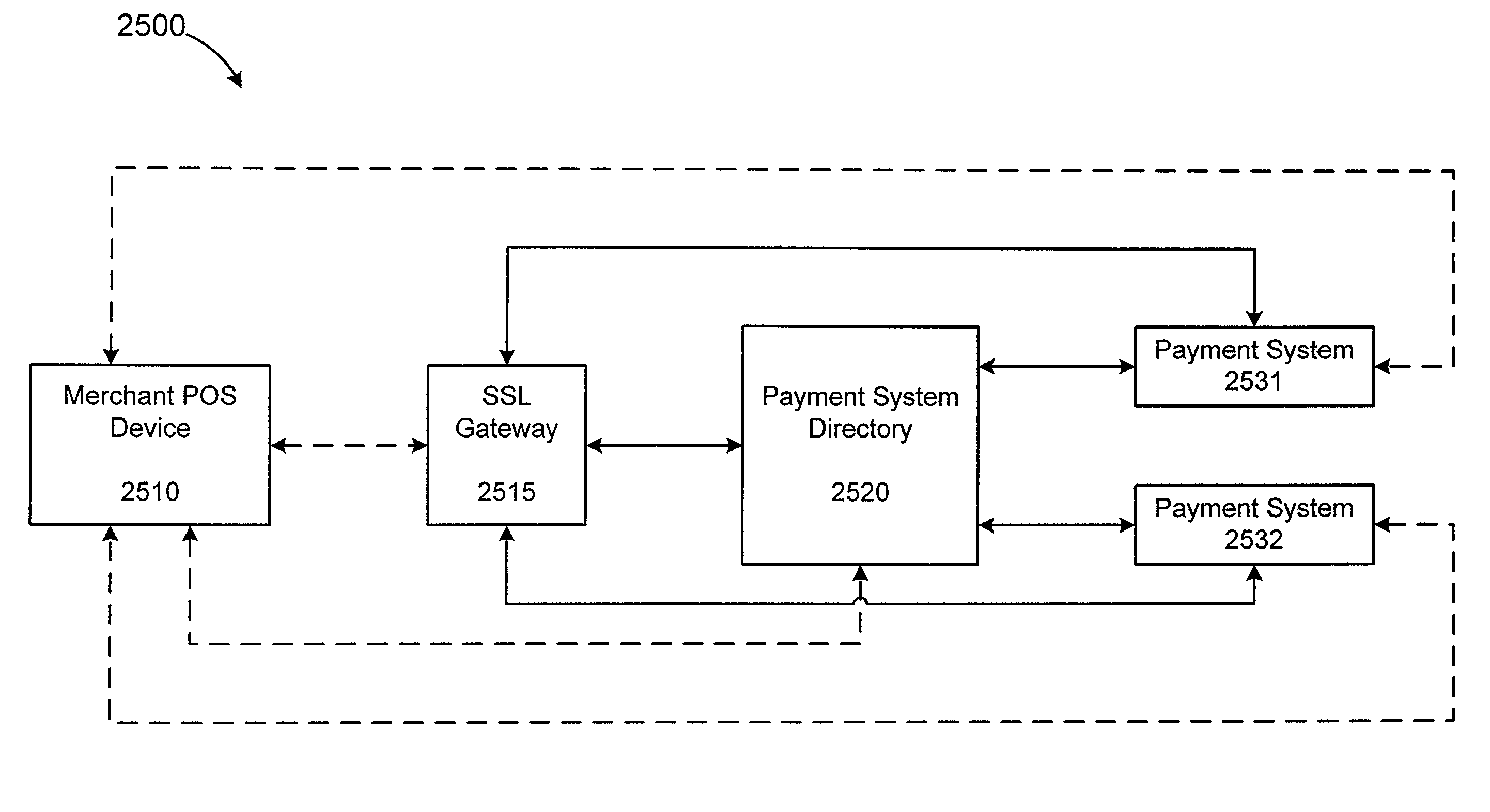

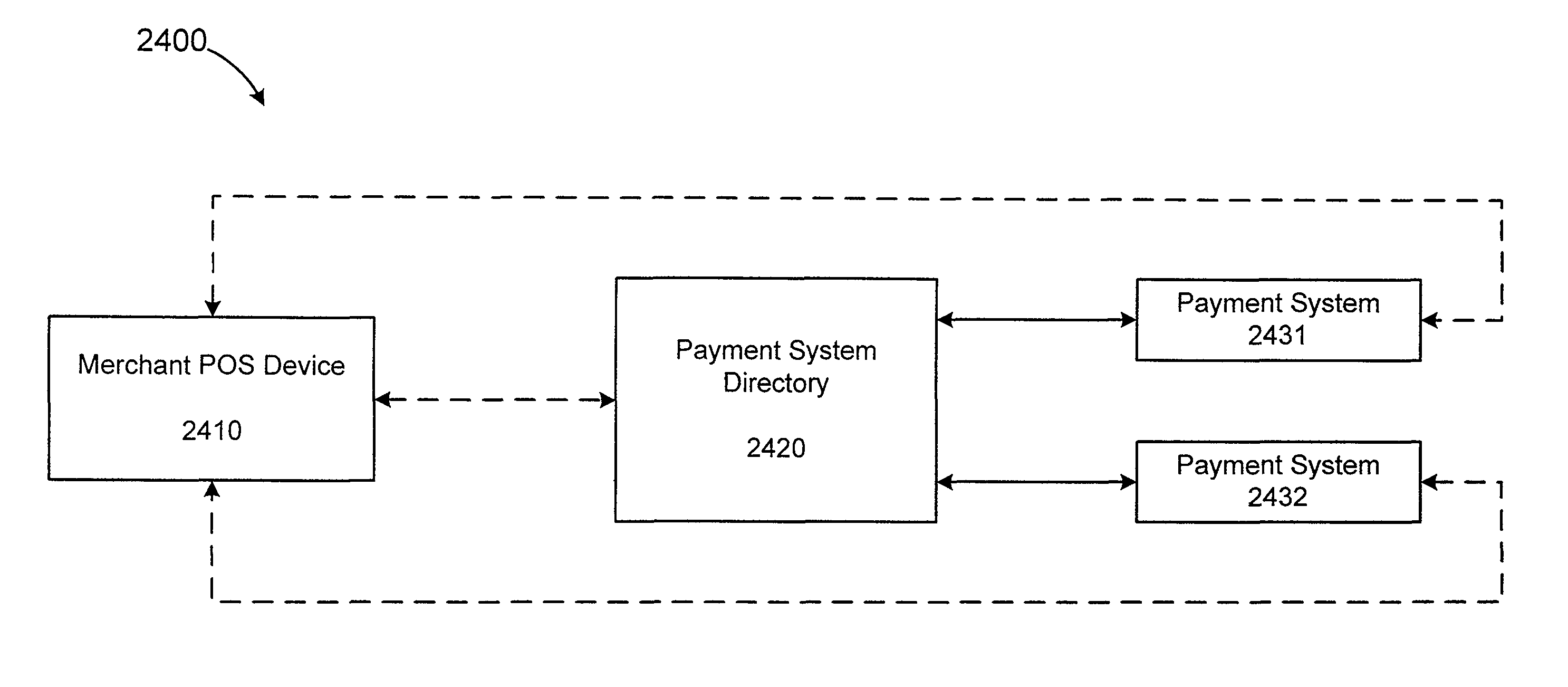

Methods for processing a payment authorization request utilizing a network of point of sale devices

InactiveUS8814039B2Easy to identifyEasy to calculateComplete banking machinesHand manipulated computer devicesThird partyIssuing bank

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

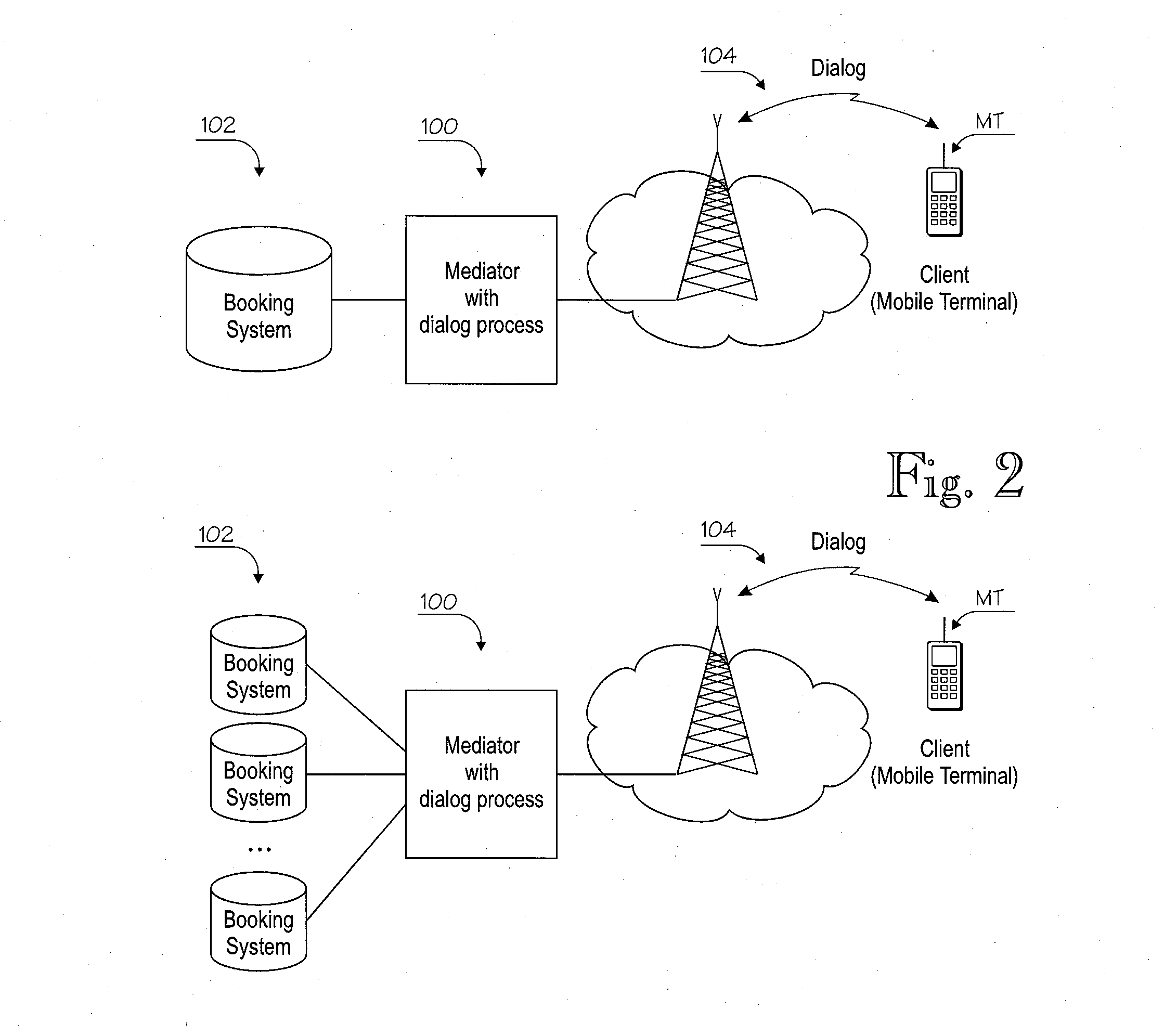

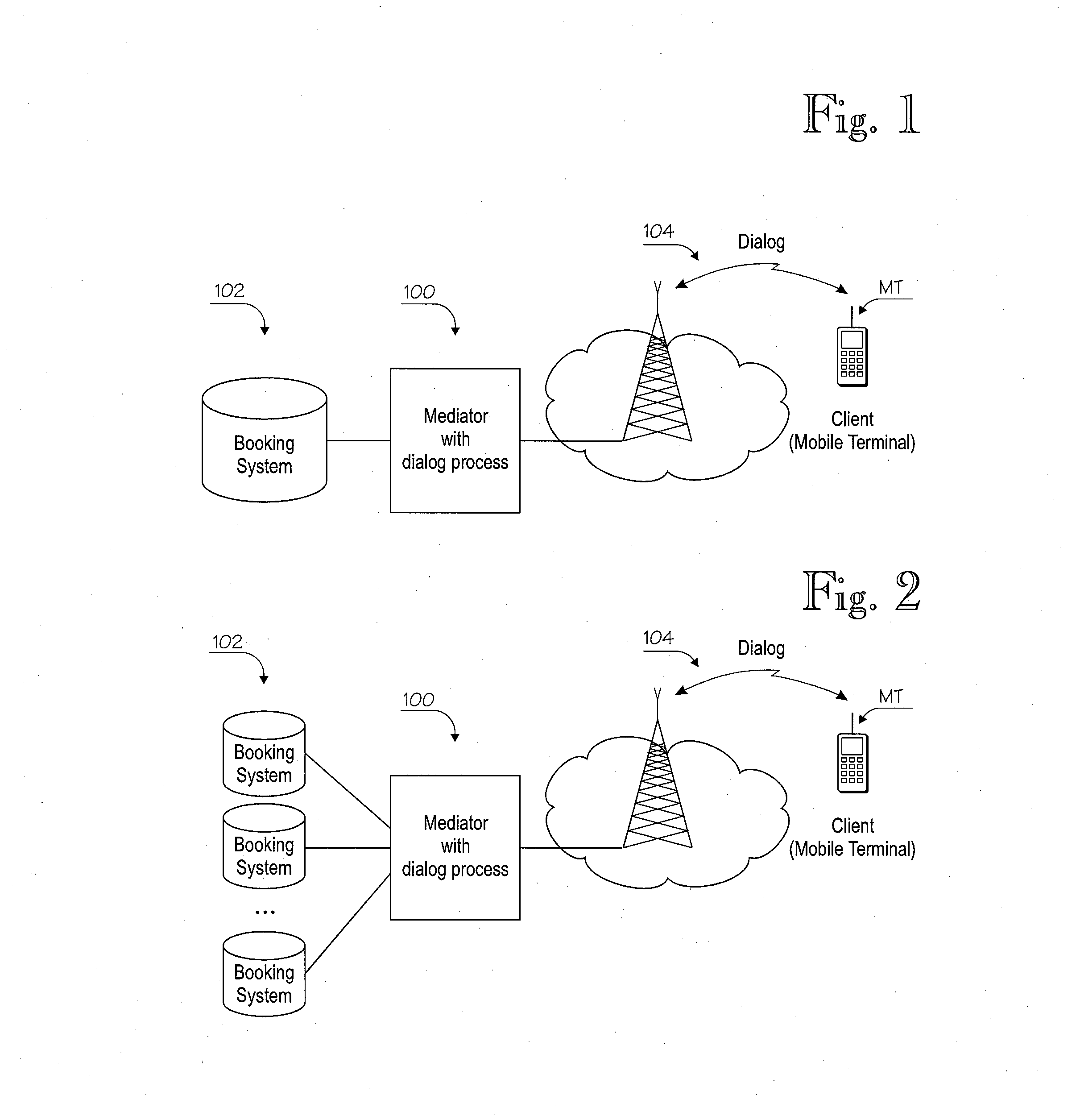

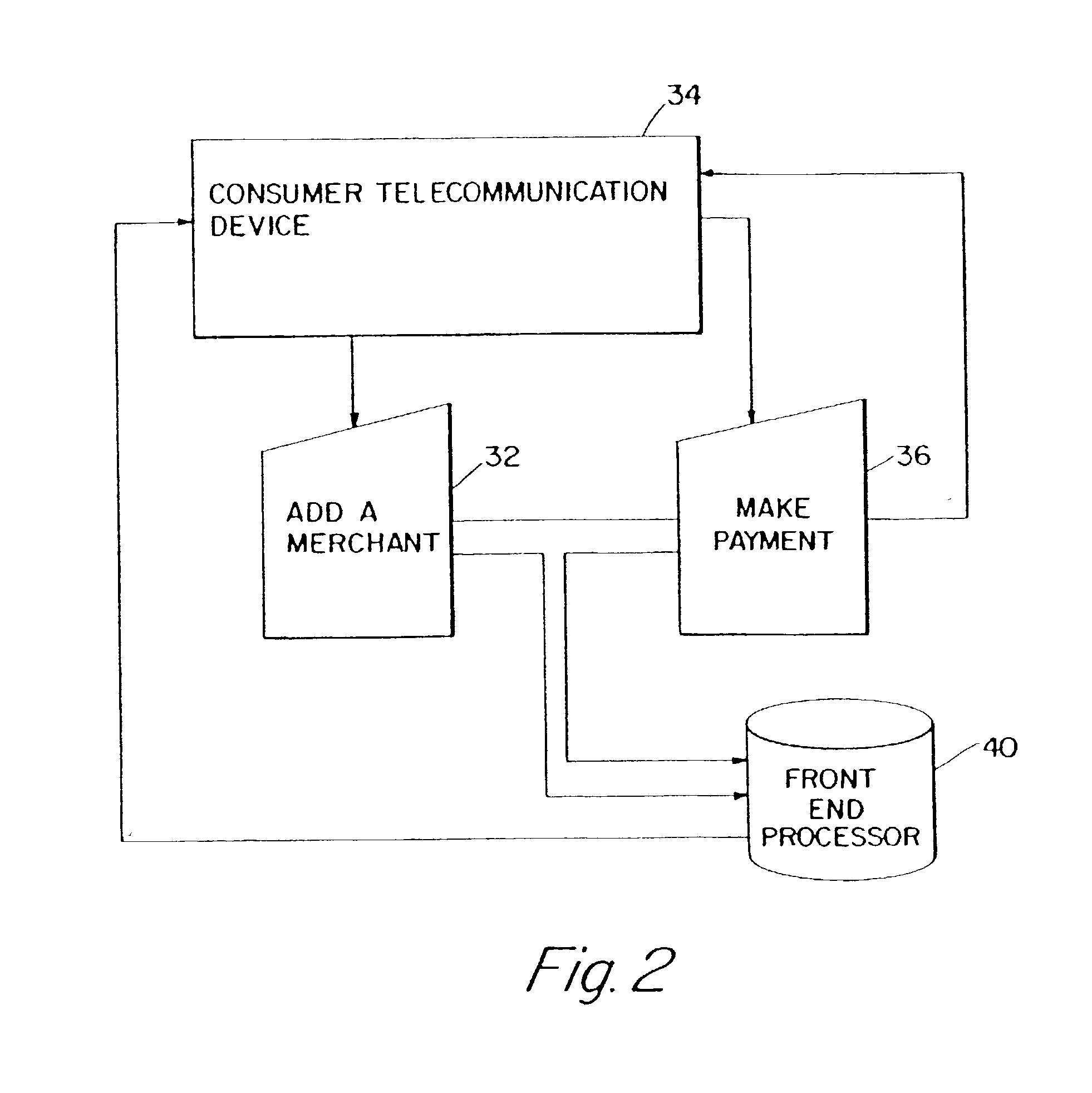

Managing recurring payments from mobile terminals

ActiveUS20120215696A1Smooth serviceConvenient introductionAccounting/billing servicesFinanceTerminal equipmentComputer terminal

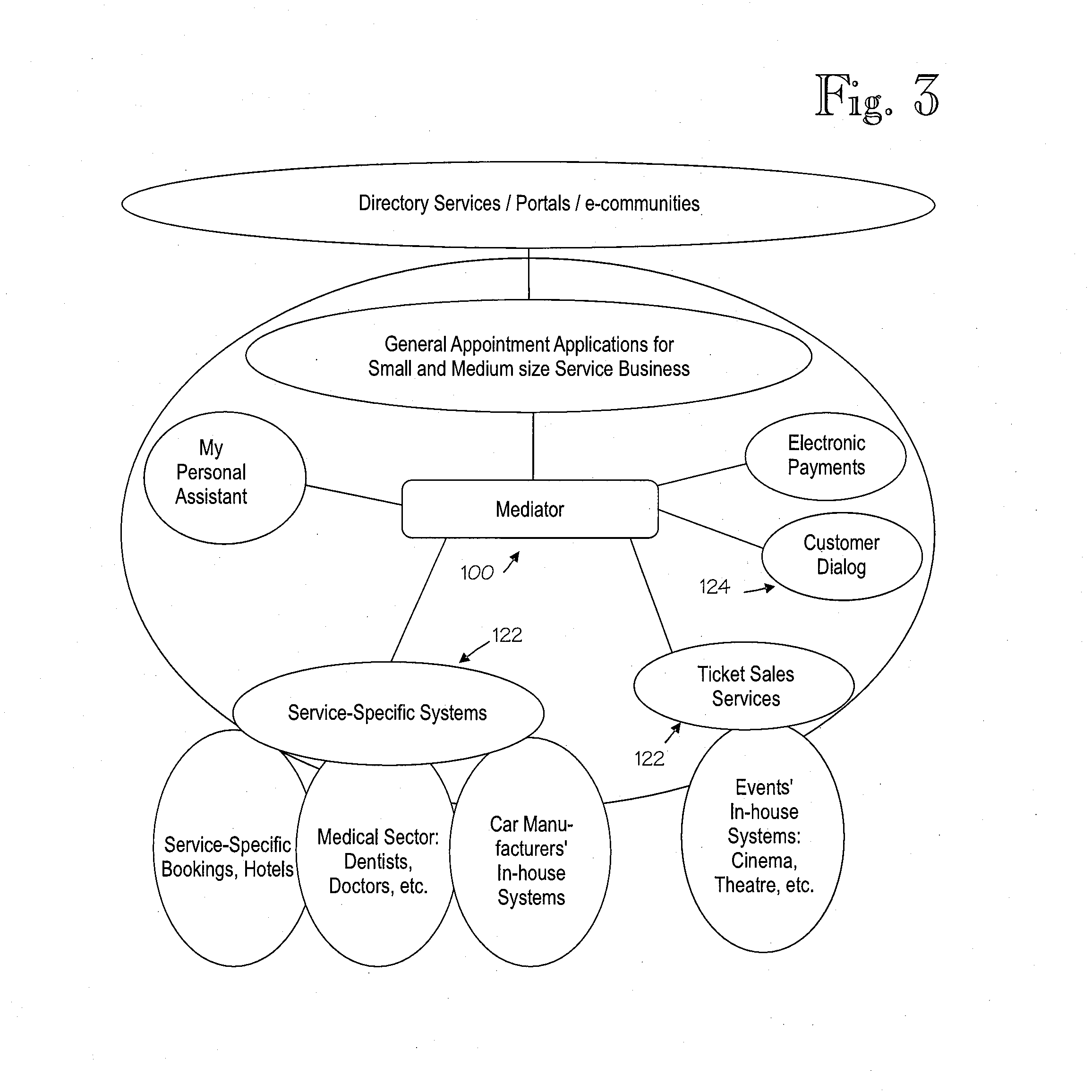

Equipment and methods for facilitating service provisioning in a system that includes a payment processor, a number of service providers and a mediator that mediates information exchange between the payment processor and service providers, and a mobile terminal operated by payment card holder. In some disclosed embodiments, service provisioning can be facilitated in cases wherein the payment processor must reside in a strictly regulated Payment Card Industry (PCI) compliant environment and the service providers operate servers that are not PCI-compliant.

Owner:SMARTCOM LABS OY

Method and system for processing financial transactions

InactiveUS20060020542A1Protection from disclosureHigh CNP interchange rateFinancePayment architectureCredit cardPayment transaction

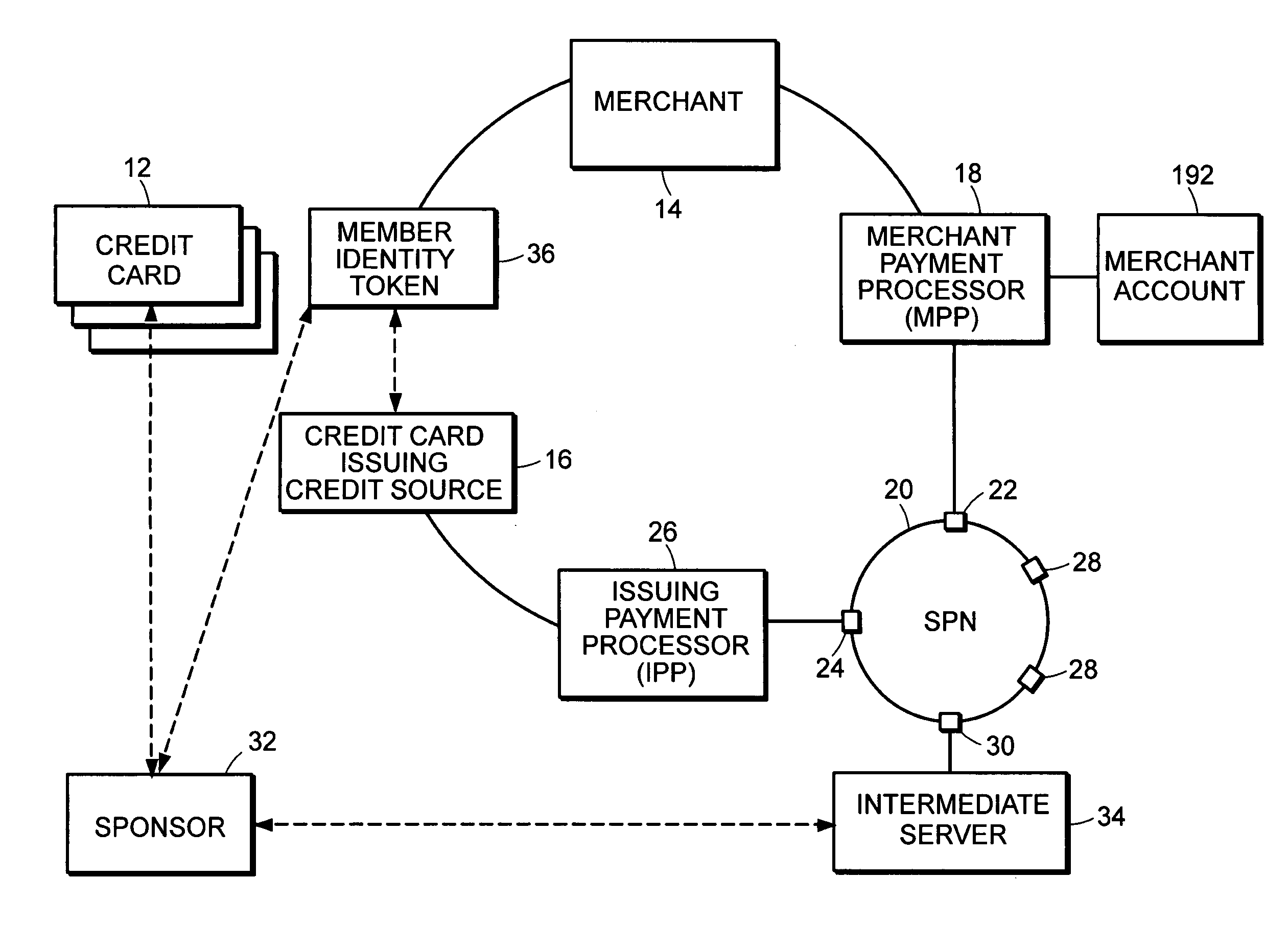

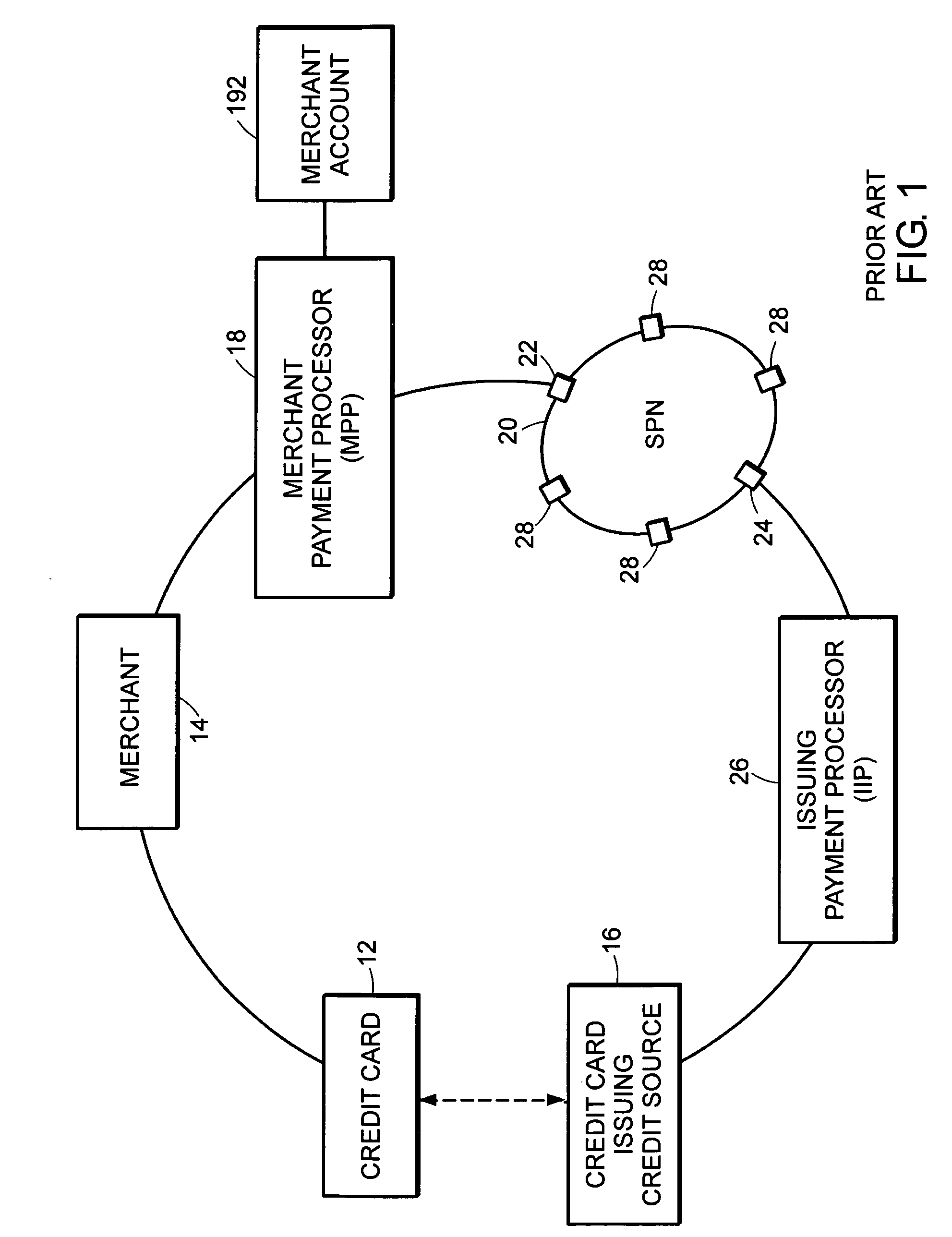

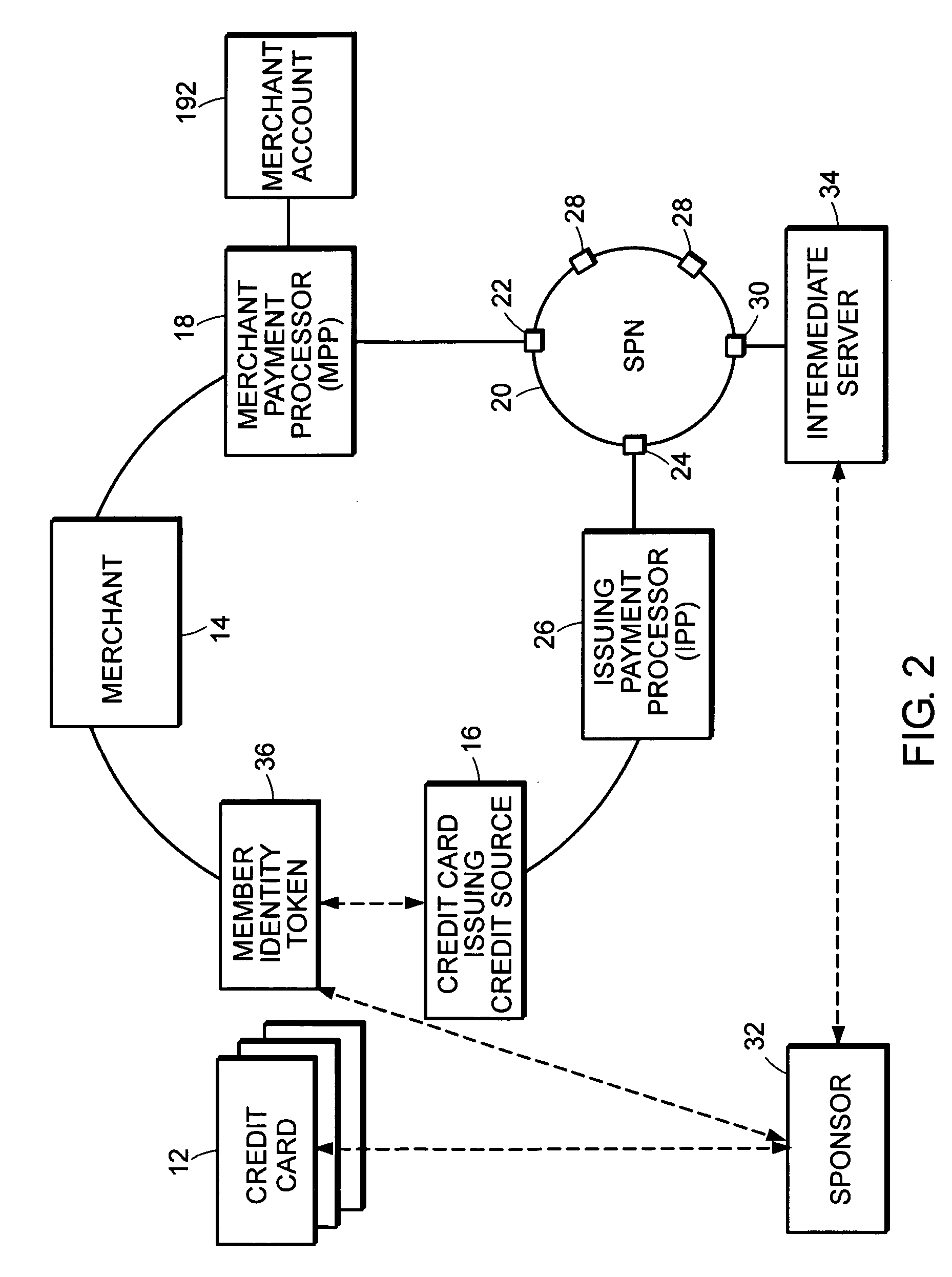

A method and system for processing financial transactions by receiving a payment transaction as an Issuing Payment Processor, converting the payment into one or more derivative transactions based on a defined rules set, and then sending, as a Merchant Payment Processor, the resulting derivative transaction or transactions to another Issuing Payment Processor, resulting in real-time settlement, faster and less costly implementation of discount, gift, and loyalty programs, and enhanced member credit card security and privacy.

Owner:PLEJ

Systems and methods for processing a payment authorization request over disparate payment networks

InactiveUS8794509B2Easy to identifyEasy to calculateComplete banking machinesHand manipulated computer devicesIssuing bankThird party

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

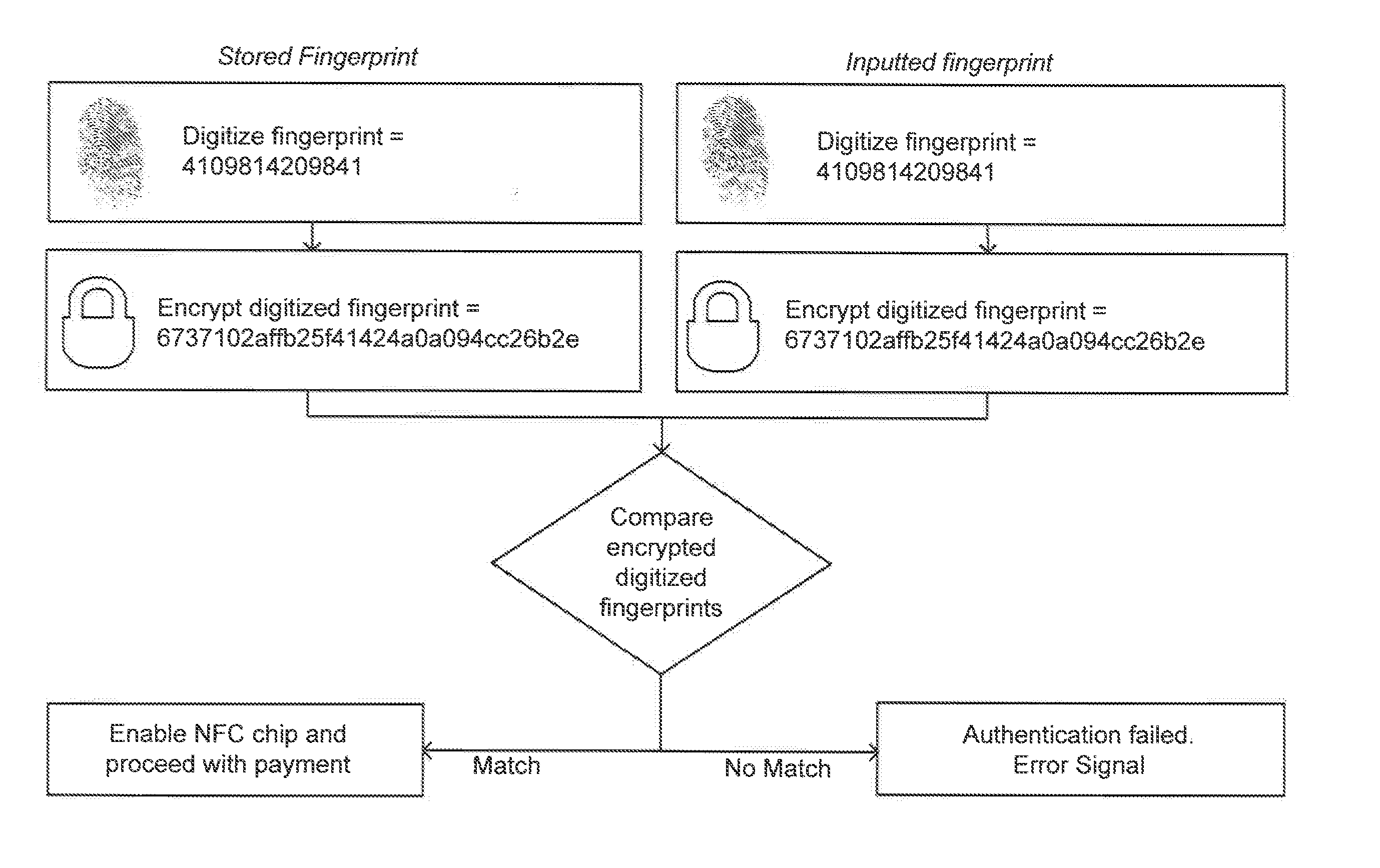

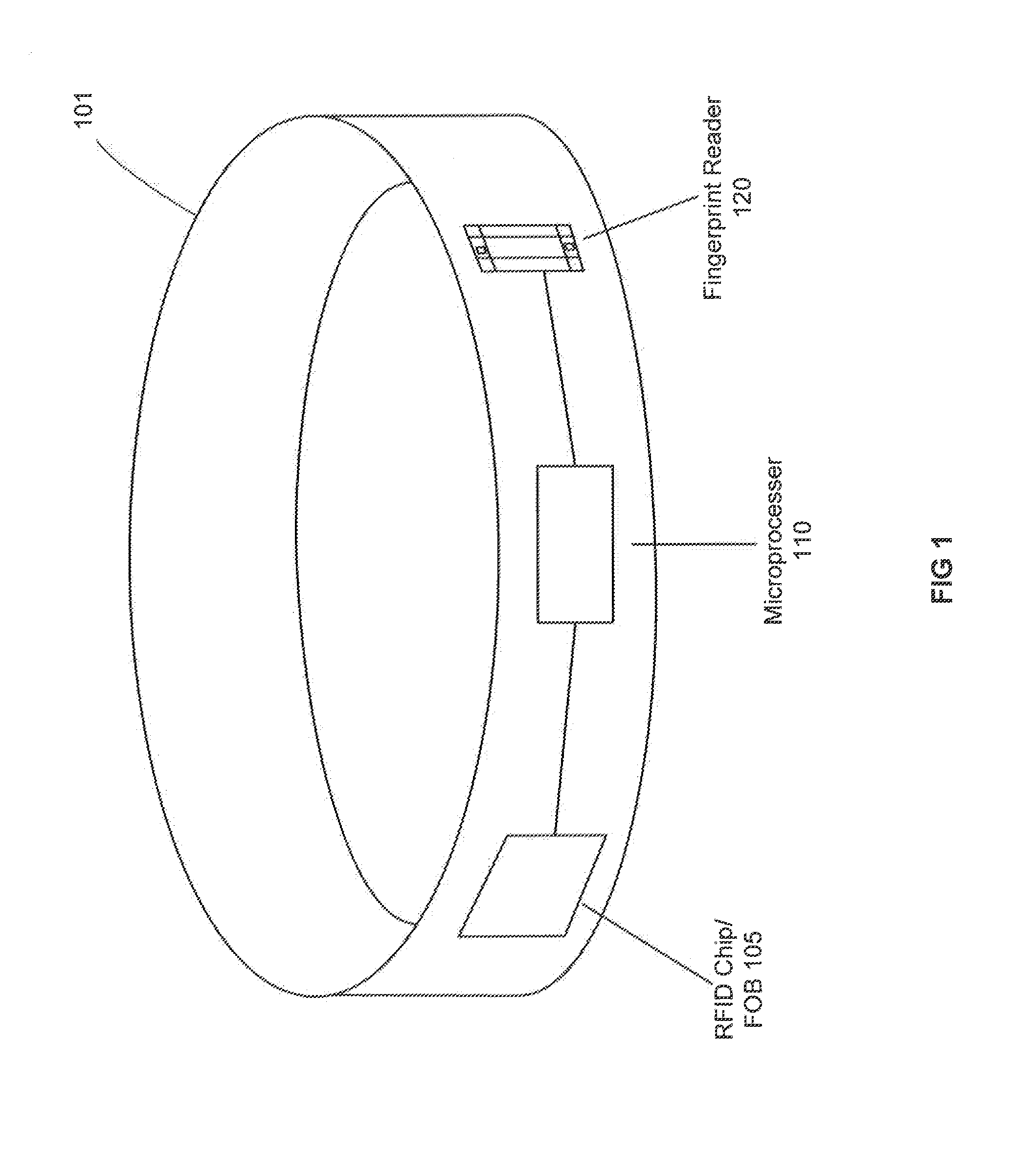

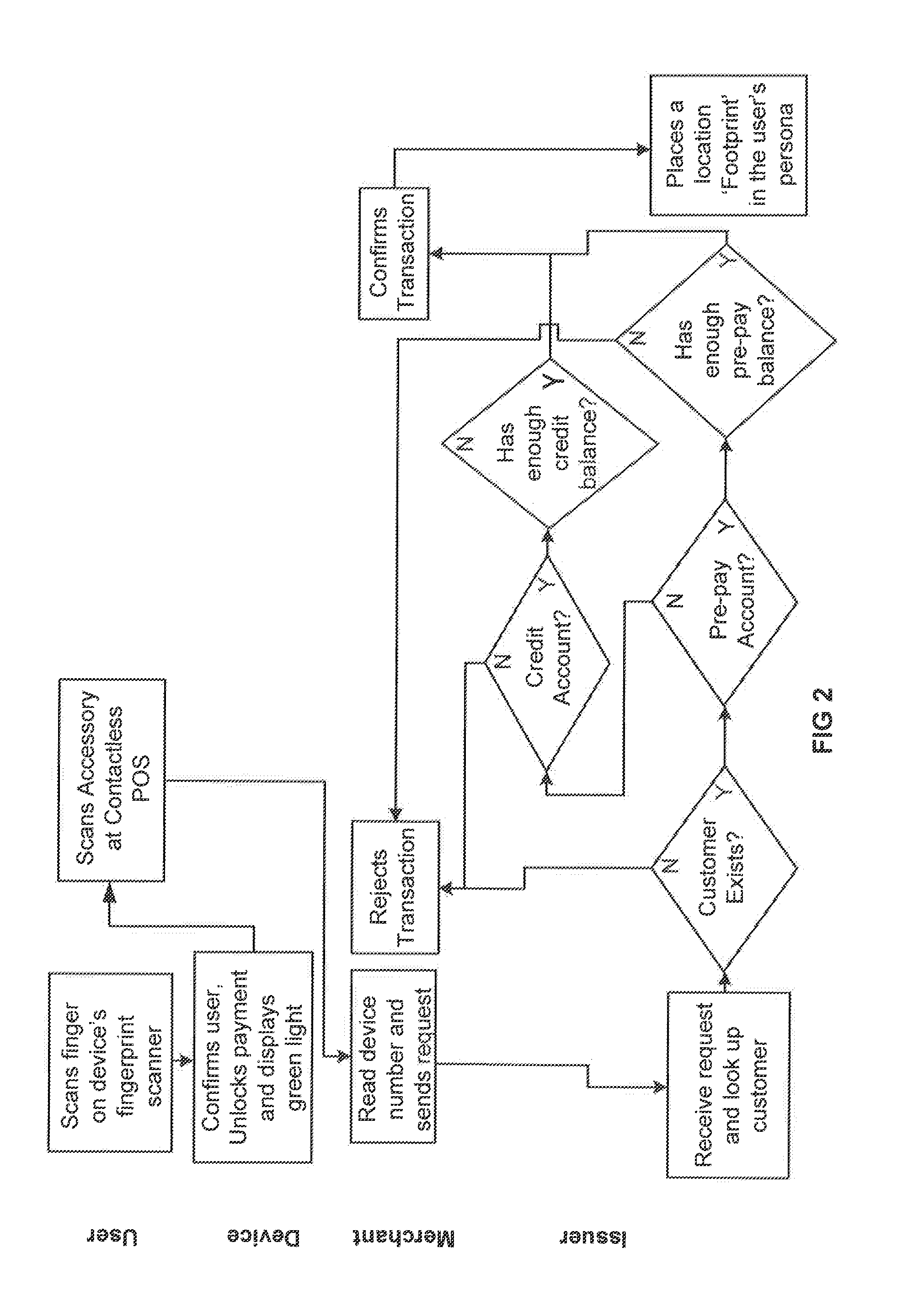

Systems and methods for non-traditional payment using biometric data

InactiveUS20070052517A1Convenient transactionFacilitate payment transactionElectric signal transmission systemsMultiple keys/algorithms usageComputer hardwareBiometric data

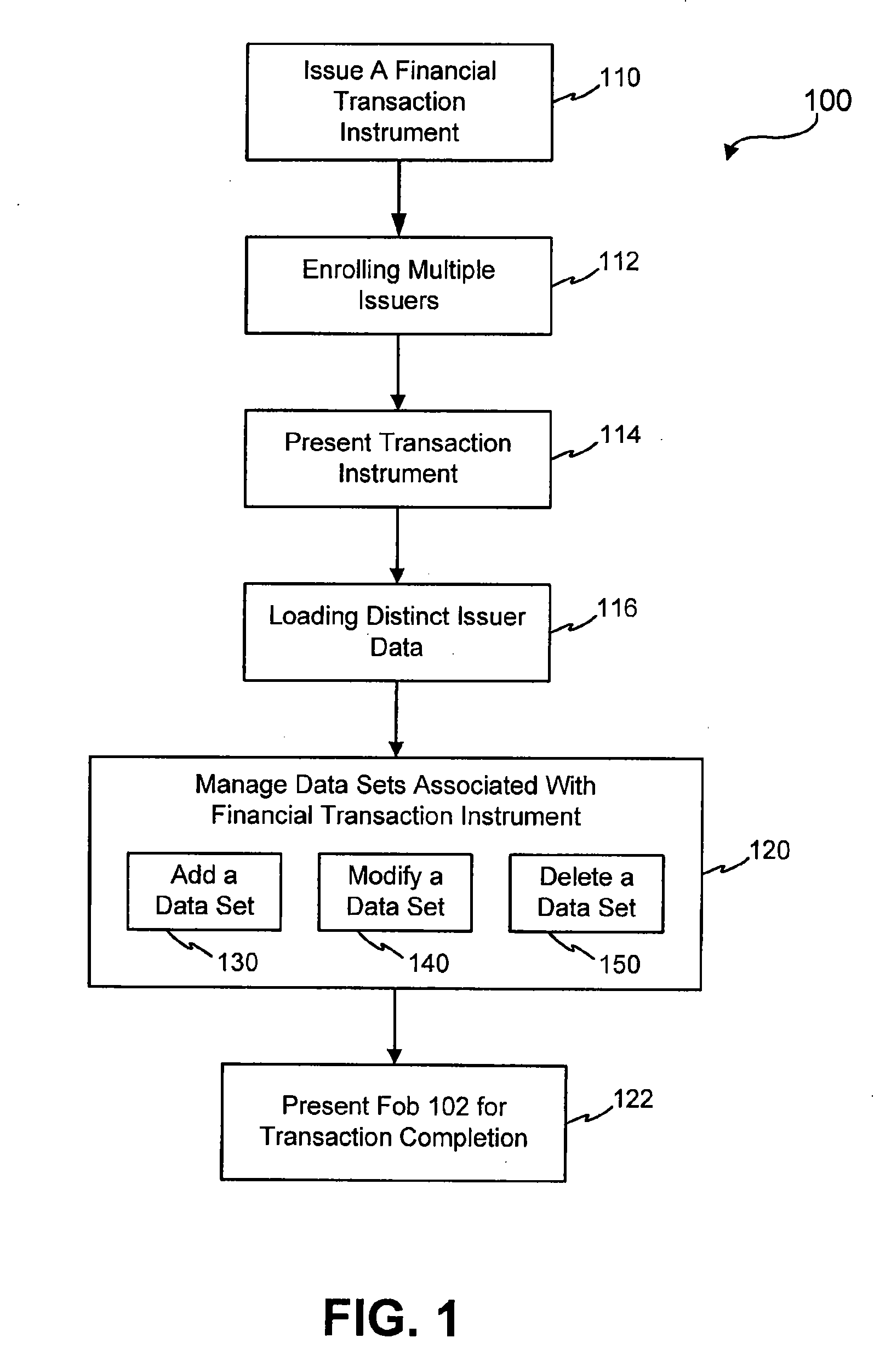

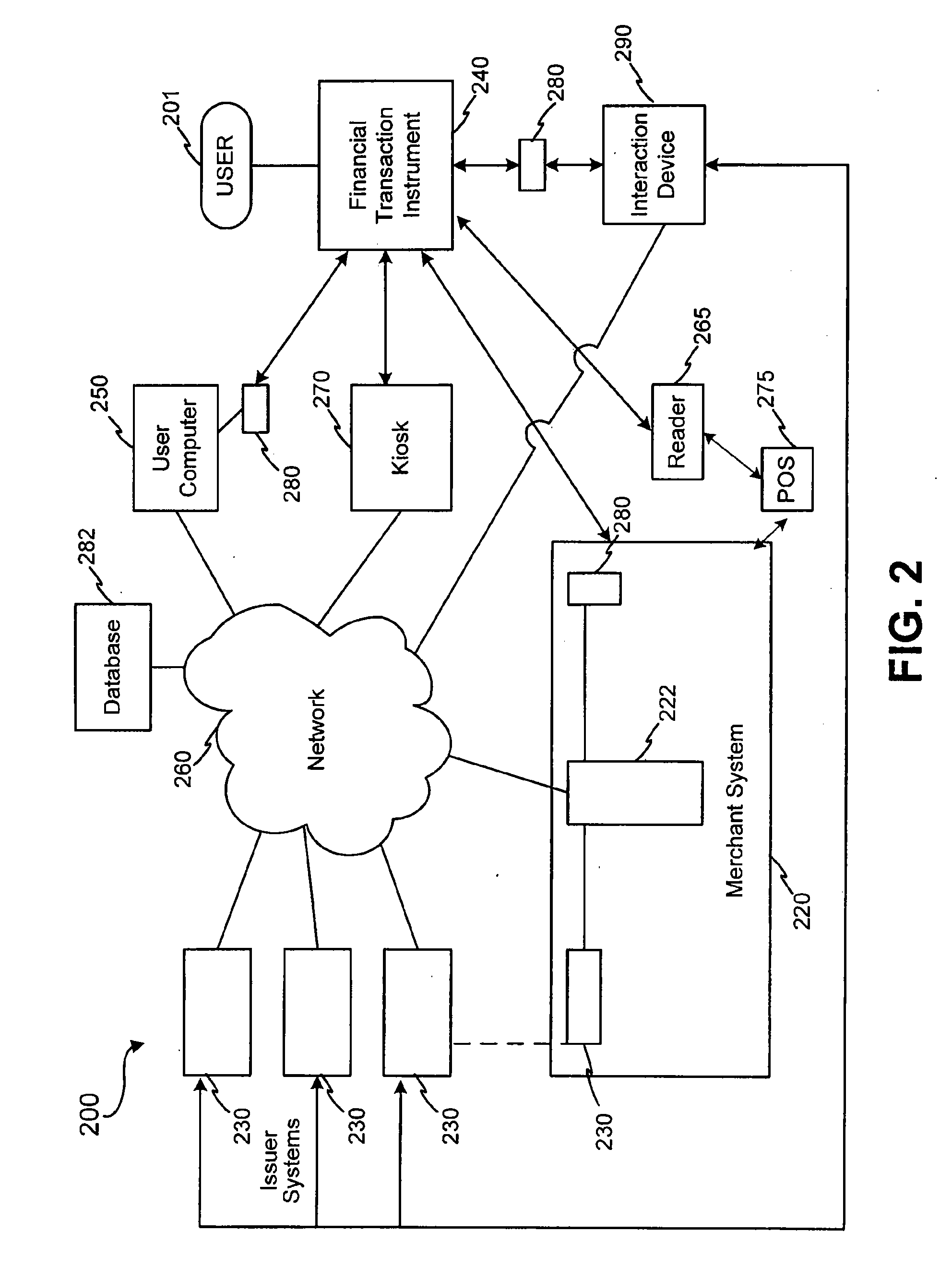

Facilitating transactions using non-traditional devices and biometric data to activate a transaction device is disclosed. A transaction request is formed at a non-traditional device, and communicated to a reader, wherein the non-traditional device may be configured with an RFID device. The RFID device is not operable until a biometric voice analysis has been executed to verify that the carrier of the RFID equipped non-traditional device is the true owner of account information stored thereon. The non-traditional device provides a conduit between a user and a verification system to perform biometric voice analysis of the user. When the verification system has determined that the user is the true owner of one or more accounts stored at the verification system, a purchase transaction is facilitated between the verification system. Transactions may further be carried out through a non-RF device such as a cellular telephone in direct communication with an acquirer / issuer or payment processor

Owner:LIBERTY PEAK VENTURES LLC

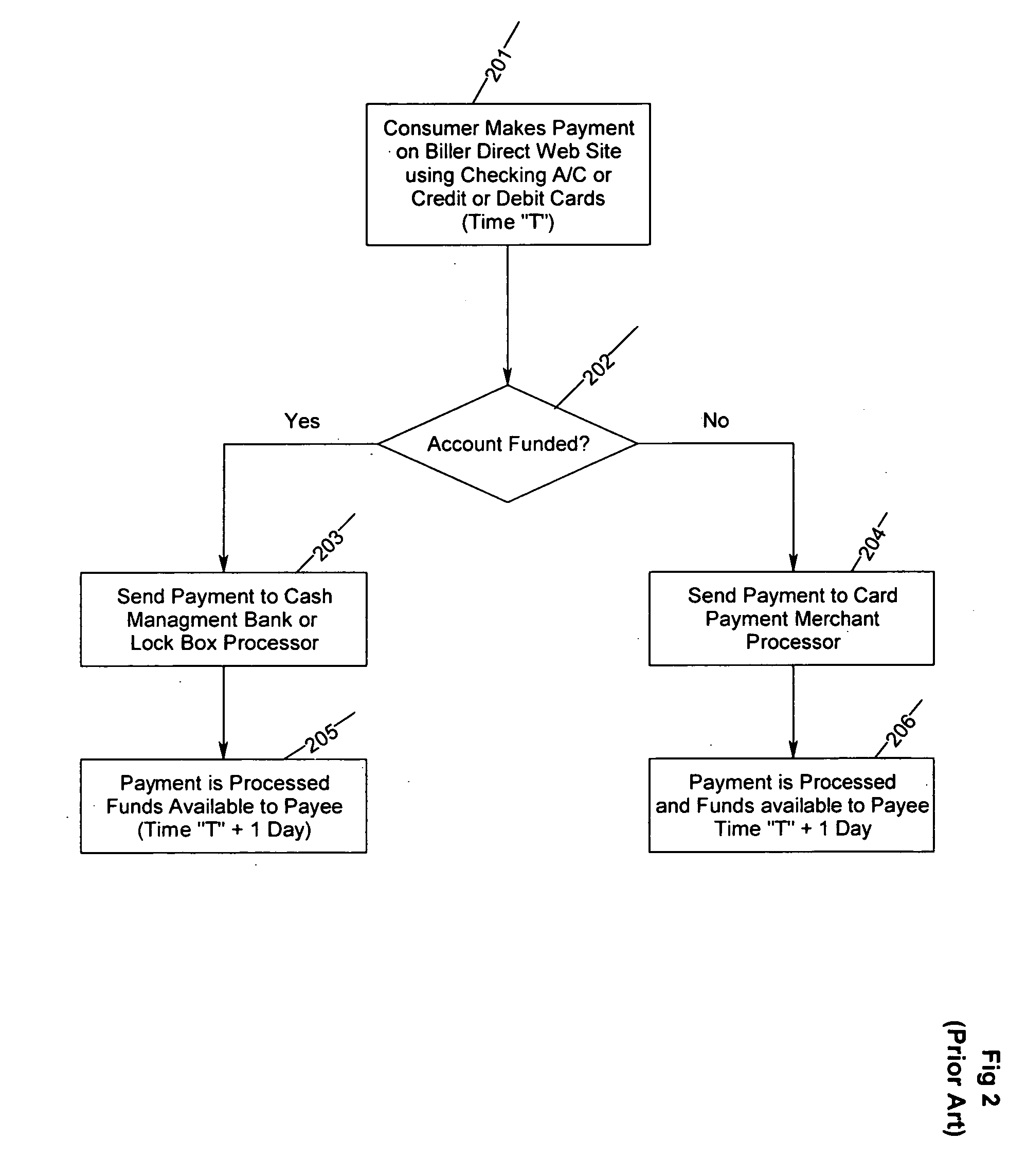

Electronic payment system for financial institutions and companies to receive online payments

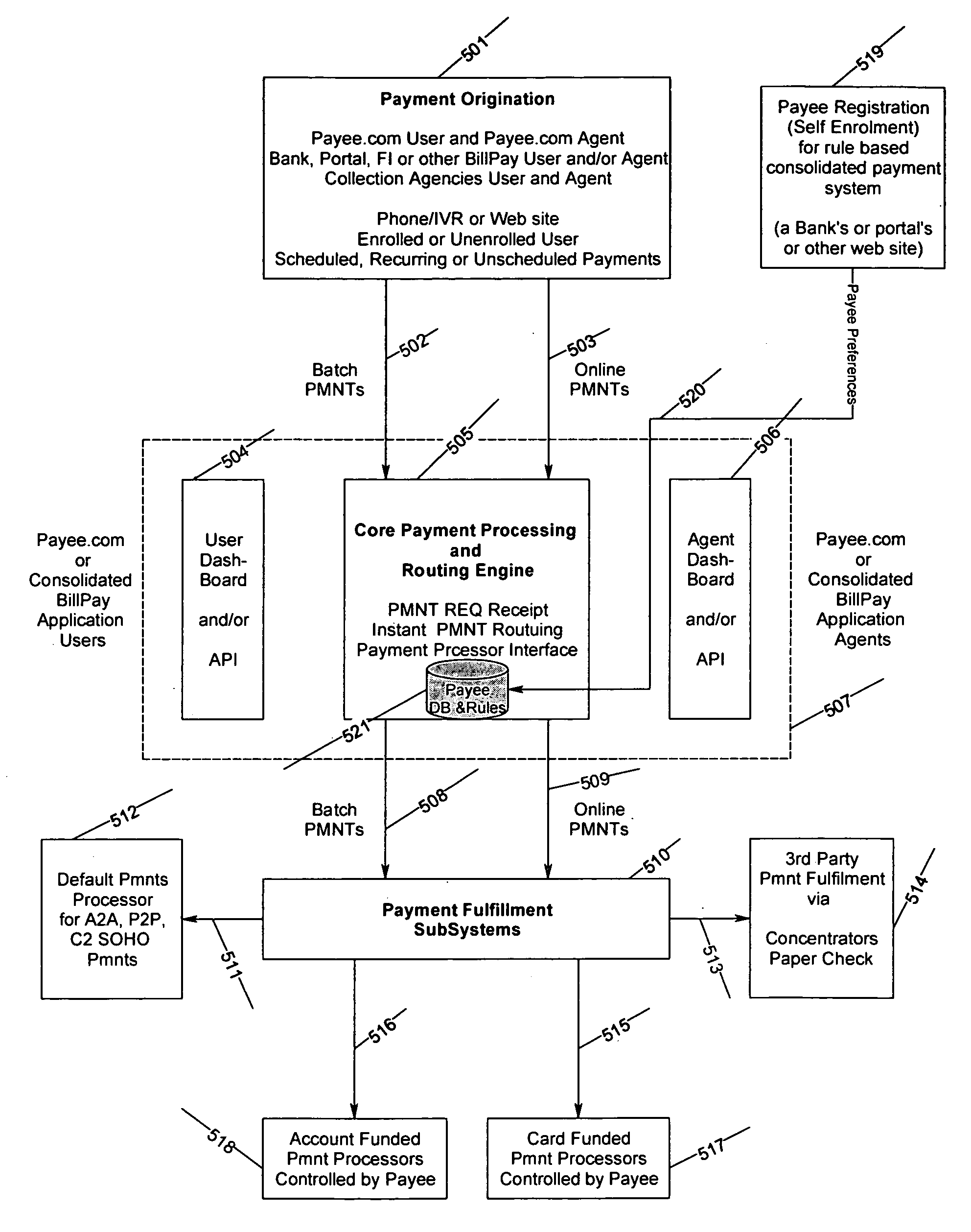

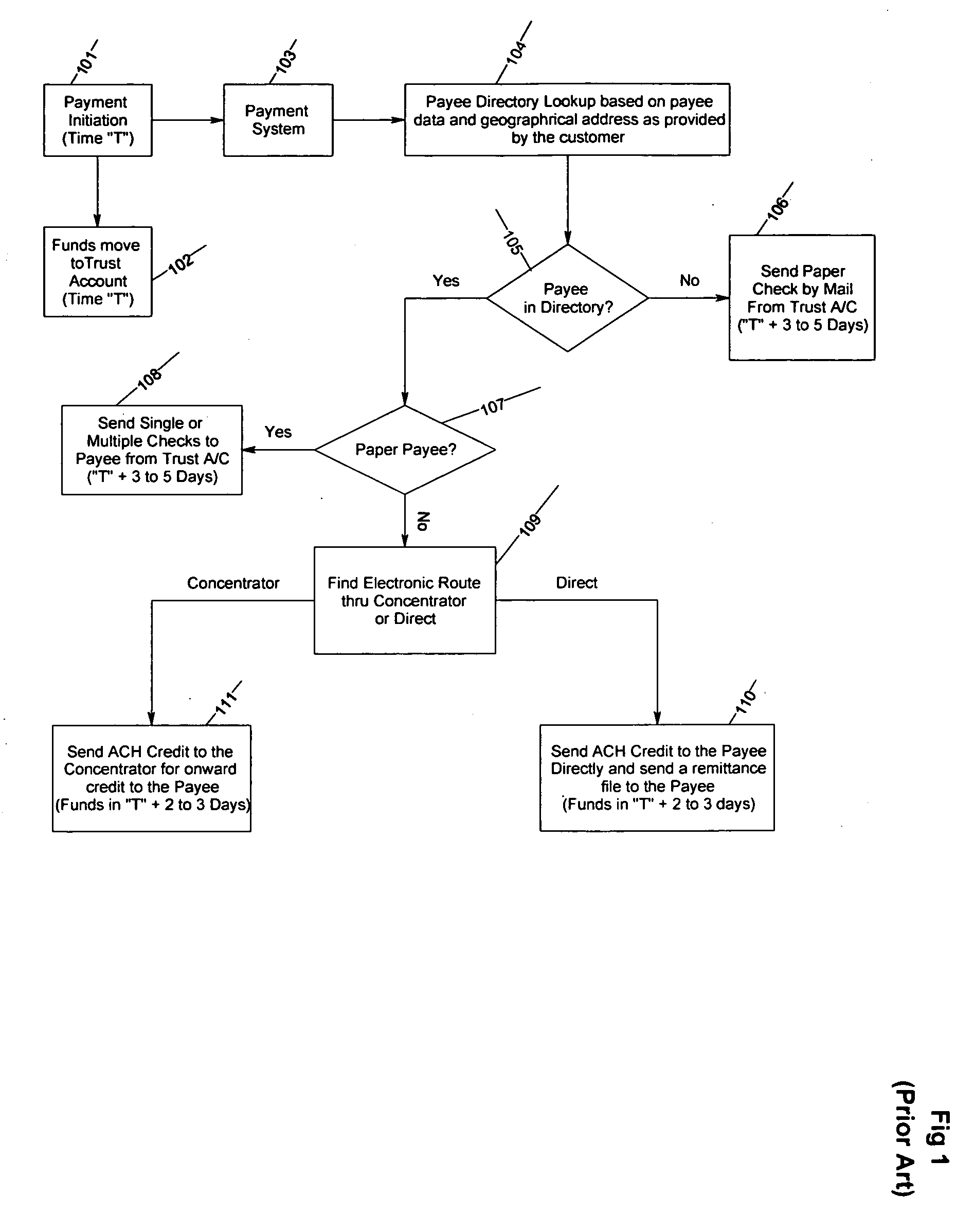

InactiveUS20060206425A1Improve consumer experienceHigh speedFinanceProtocol authorisationPayment transactionPersonal account

The present invention provides an a electronic payment system for bank, financial institutions, portals and companies to receive payment from their customers for one or more payees. The electronic payment system allows payer (consumer or business) to use any funding method (bank account, credit / debit cards or any other business or personal account or method associated with one or more banks) accepted by the payee to initiate a payment and the payment transaction is routed to the appropriate payment processor based on payee's preferences. The electronic payment system also provides a instant payment delivery notification to the payer directly from the payee. The system also creates a unique payment tracking number which can be used by all parties associated with the transaction to track a payment's status and other attributes associated with the payment. The electronic payment system also provides a rule based payment management system for the payees to use for managing the processing and posting of the payments. The system also allows for payees to manage their payments received and post to various receivable systems based on rules defined. Additionally, the system allows payees to create rules for other aspects of payment processing. The system also allows for much simplified electronic bill delivery system which uses biller's existing infrastructure to create bill data for distribution to 3rd party consolidators.

Owner:PAYMENTUS CORP

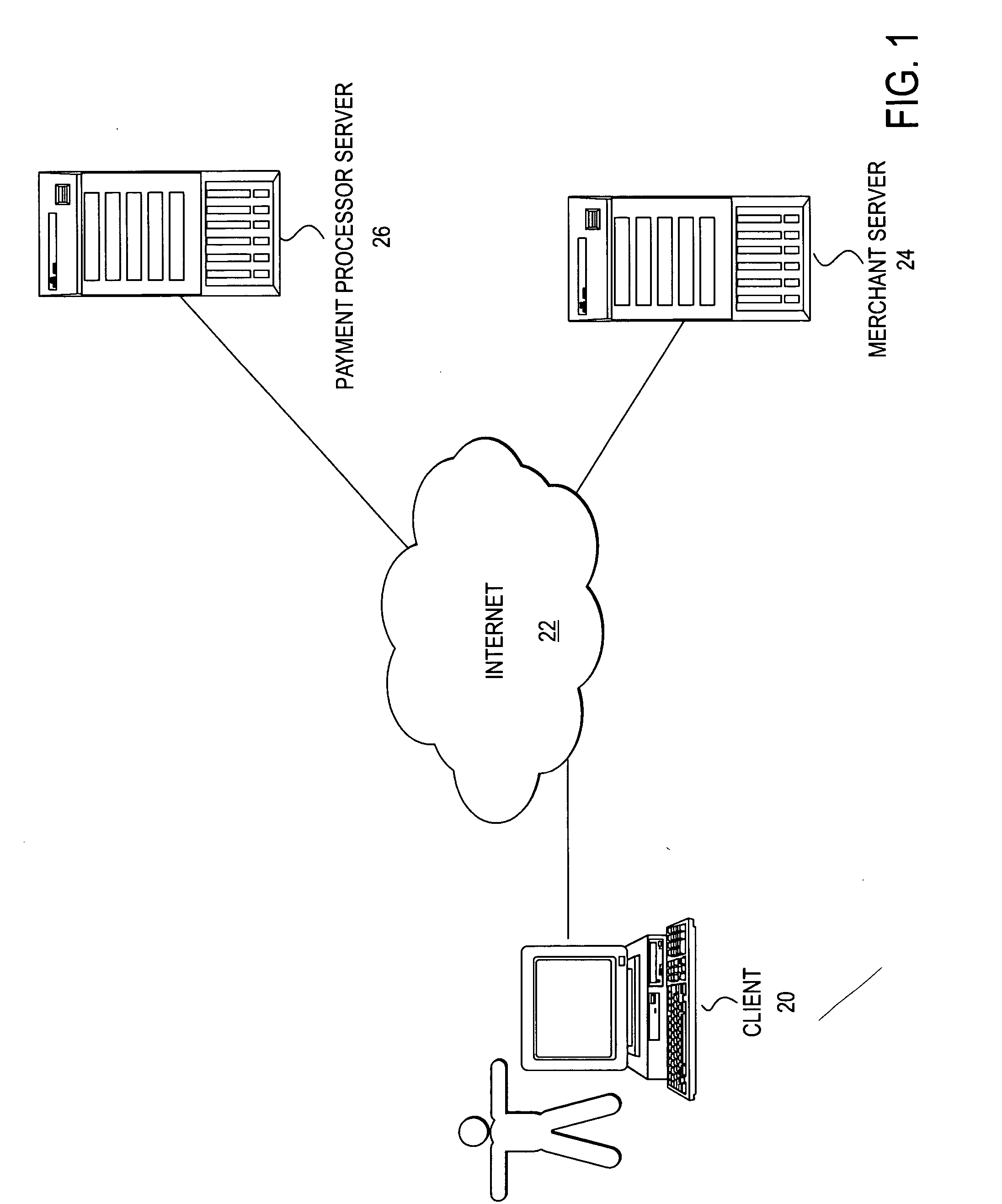

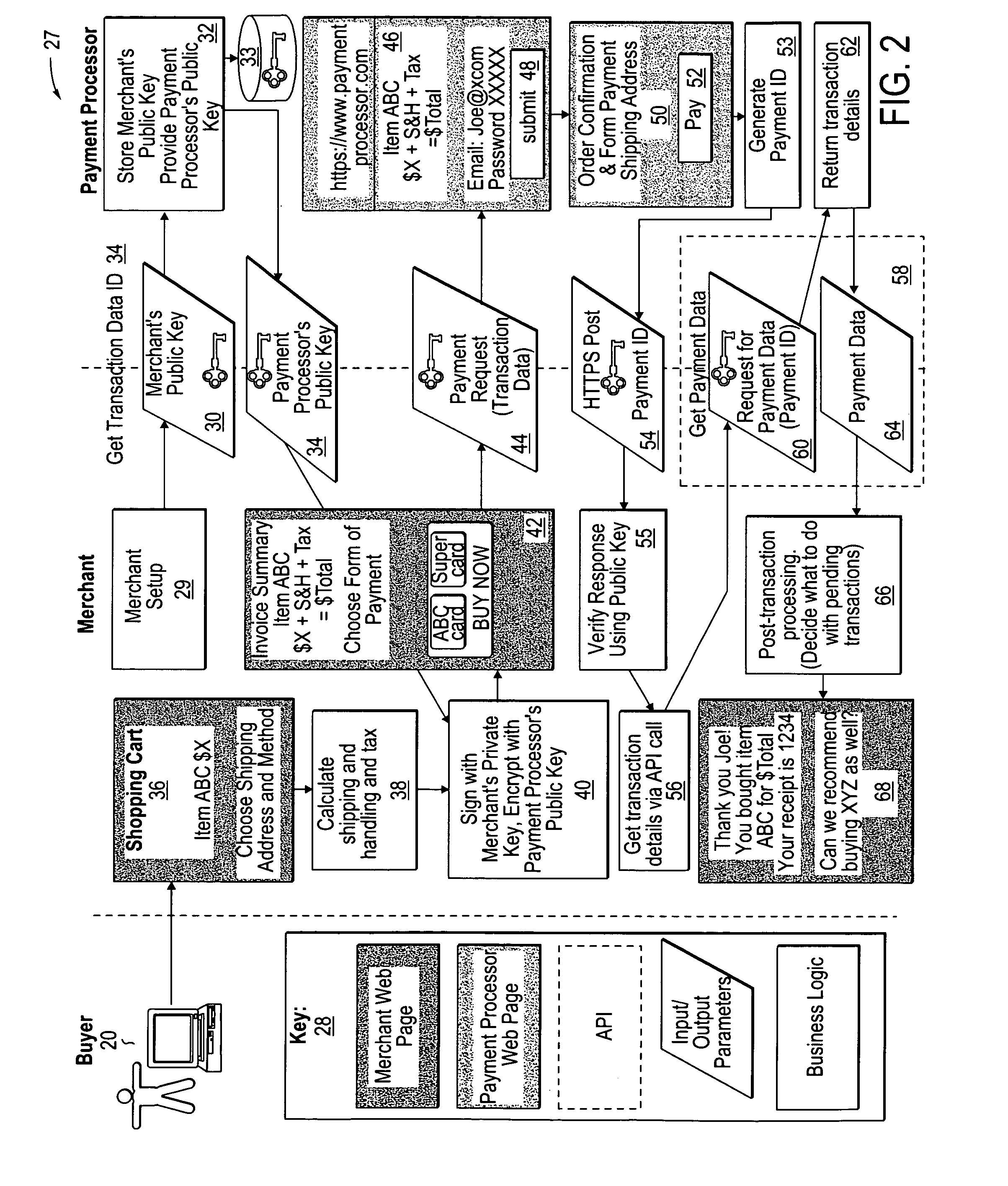

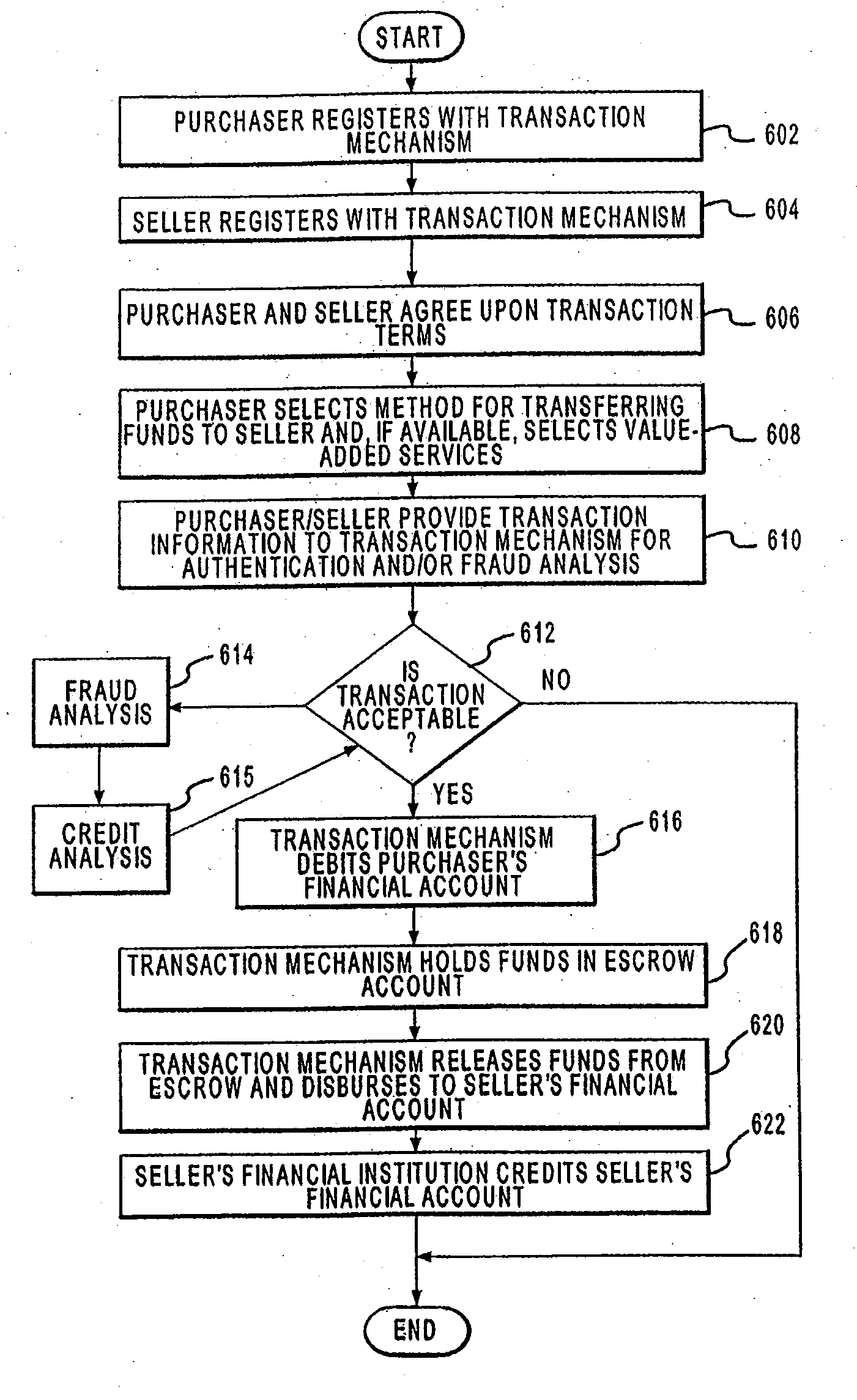

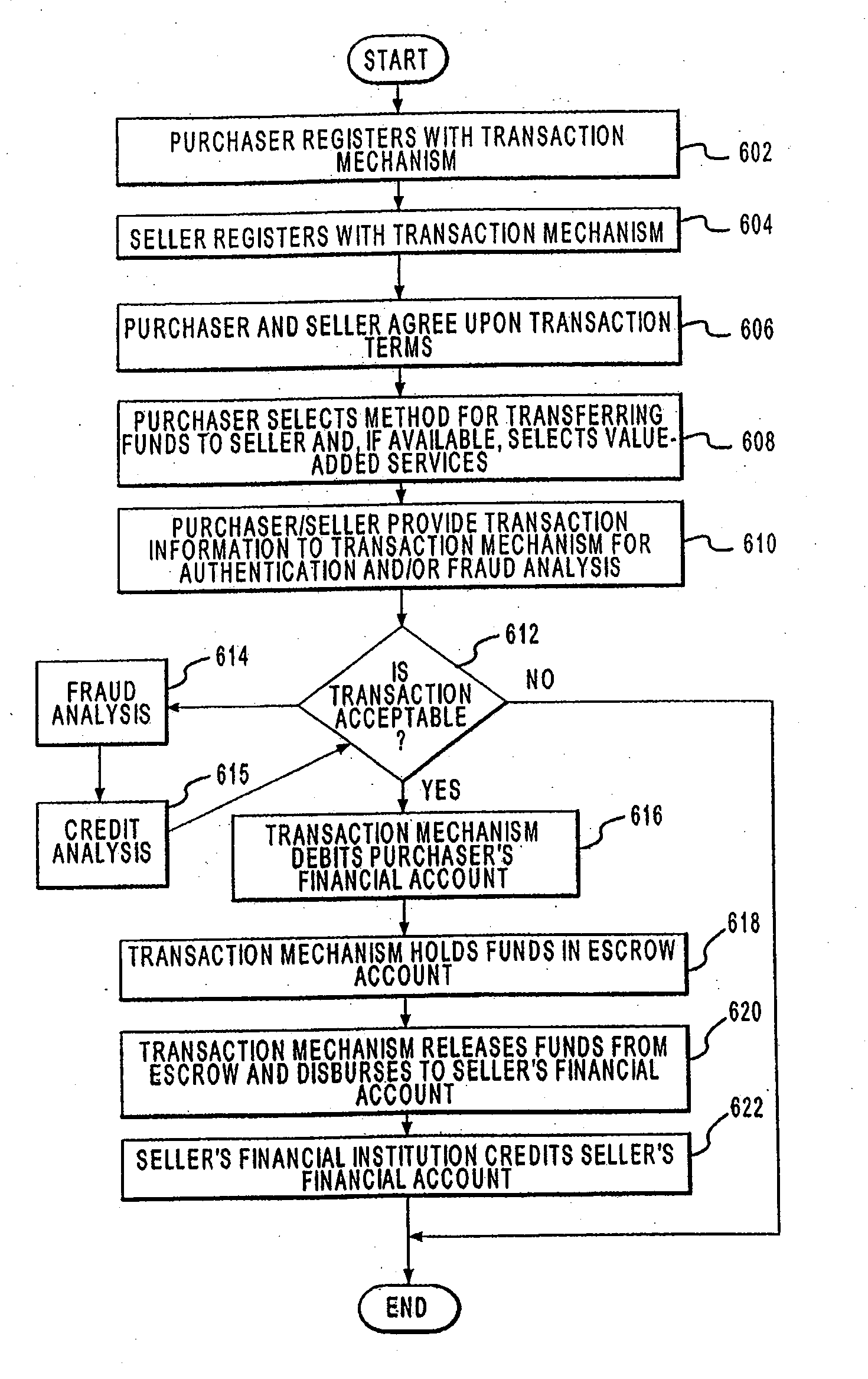

Method and system to facilitate securely processing a payment for an online transaction

ActiveUS20050256806A1Buying/selling/leasing transactionsPayment circuitsMerchant servicesInternet privacy

A computer-implemented method, to facilitate processing a payment for an online transaction, includes, responsive to receiving secure transaction data from a merchant server, using a payment processor to generate a transaction data identifier to identify the transaction data. The payment processor communicates the transaction data identifier to the merchant server. In response to receiving a request to process a payment, including the transaction data identifier, the payment processor requests user credentials from a user. Upon receiving user credentials from the user, the payment processor verifies the user credentials. The payment processor processes the payment and generates a payment identifier to identify payment data associated with the payment. The payment processor communicates the payment identifier to the merchant server. Upon receiving a request for payment data, including the payment identifier, over a secure communication channel from the merchant server, the payment processor communicates the payment data to the merchant server.

Owner:PAYPAL INC

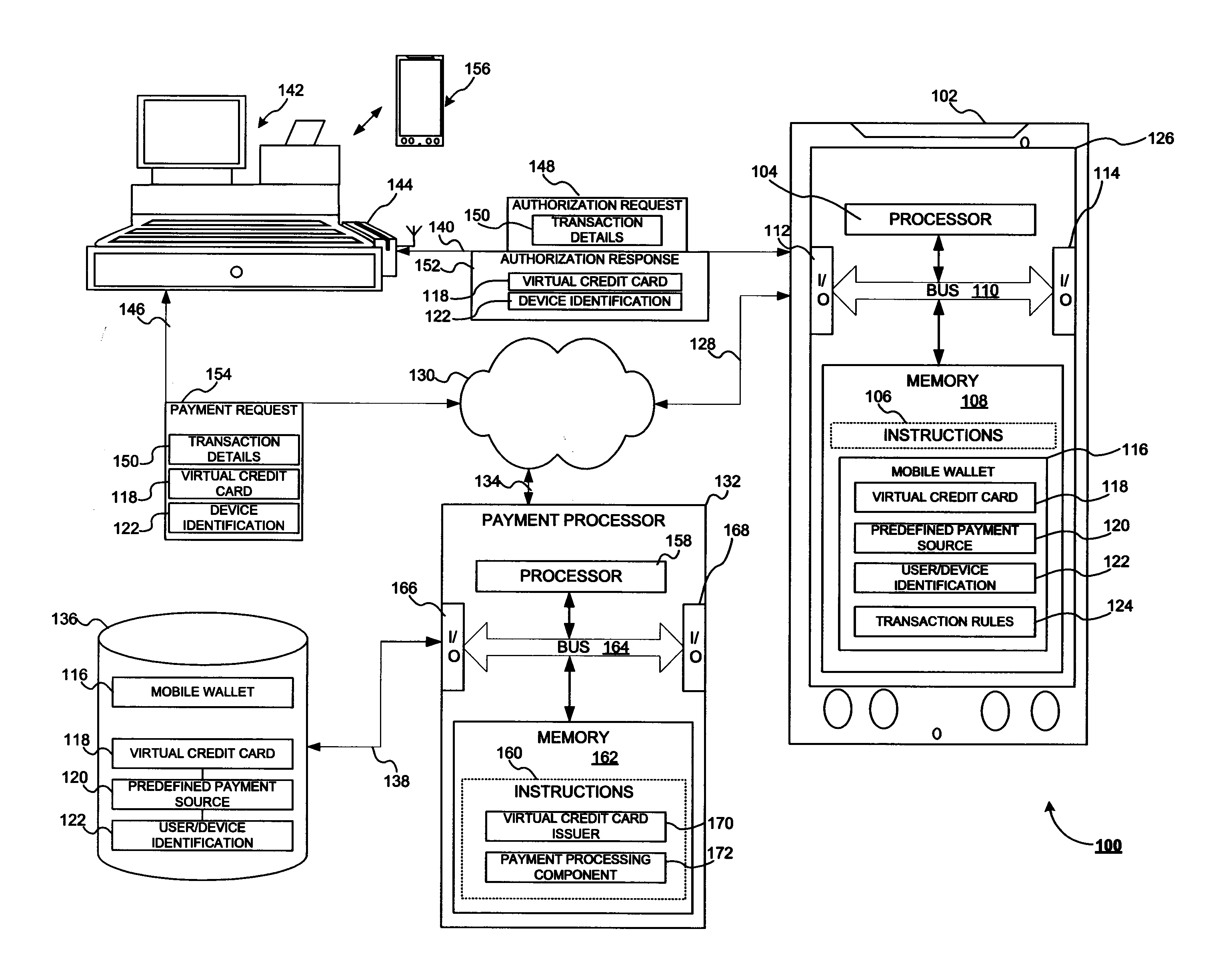

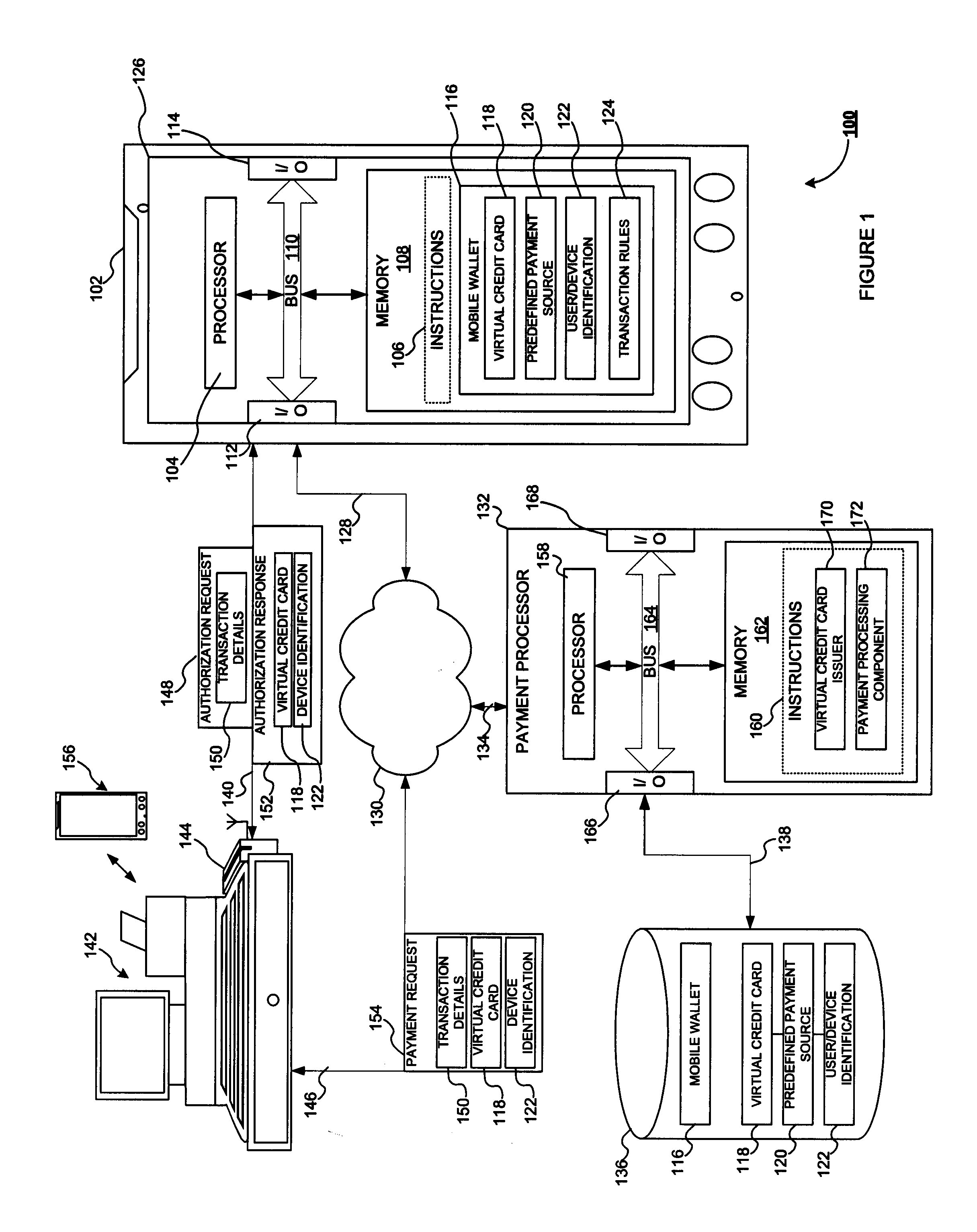

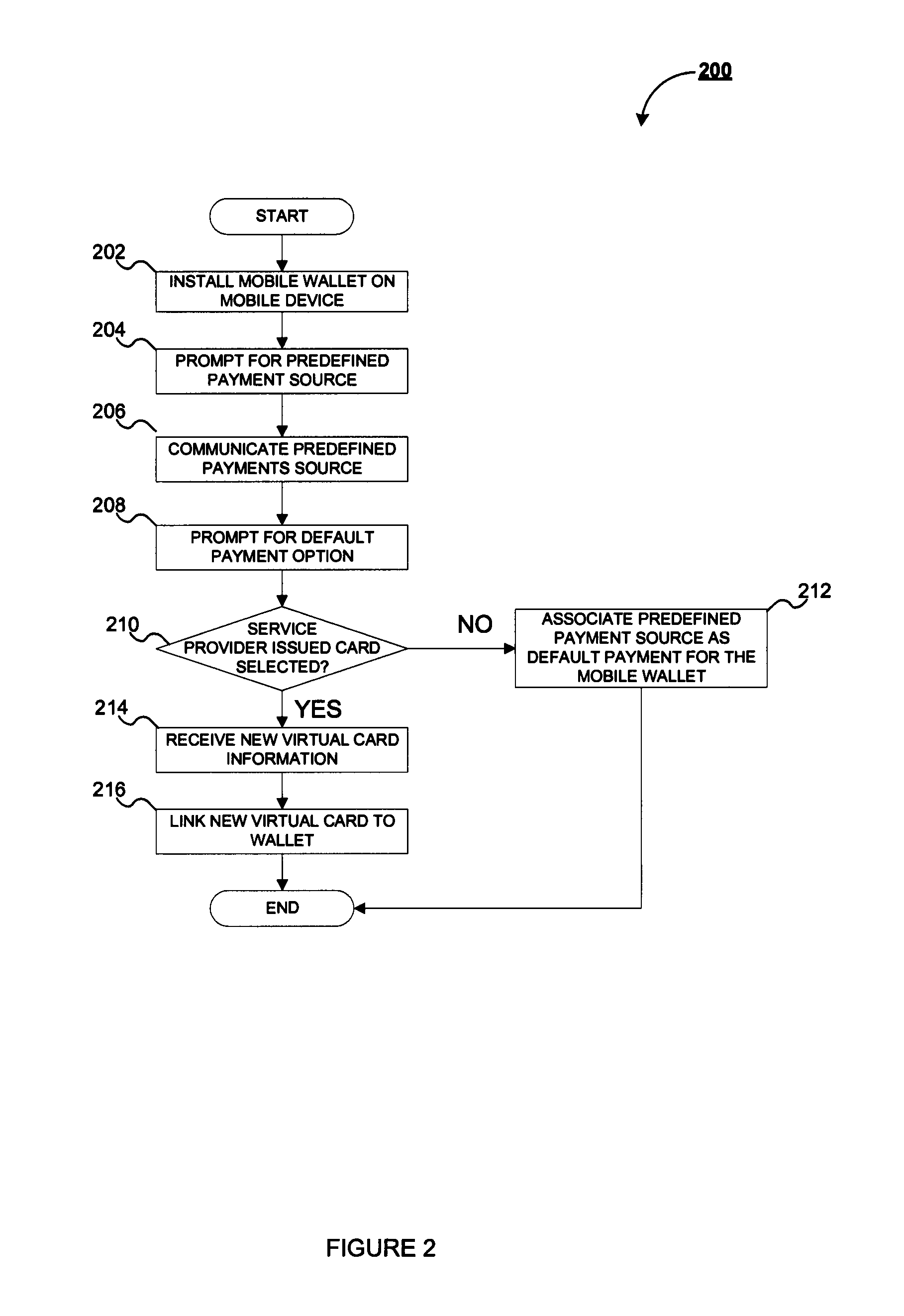

Mobile wallet payment processing

A method and system for mobile wallet payment processing. A request may be received from a mobile wallet operative on a mobile device for a virtual credit card, the request including device identification and a predefined payment form. A virtual credit card is dynamically issued by a payment processor responsive to the request. The virtual card is communicated to the mobile wallet on the mobile device and used to authorize a transaction with a vendor. A payment request is received from the vendor by the payment processor, which includes the virtual credit card, transaction details, and the identification of the mobile device authorizing the transaction. Upon verification of the information in the payment request and available funds, the payment processor processes payment for the transaction using the virtual credit card, with the predefined payment form used to satisfy any charges incurred by the virtual credit card.

Owner:CARTA WORLDWIDE

Secure payment and billing method using mobile phone number or account

ActiveUS20110295750A1Metering/charging/biilling arrangementsAccounting/billing servicesMobile Telephone NumberAuthorization

A system, method and computer program product for processing payments for goods or services, including a payment processor that receives a payment request from a merchant for goods or services and that includes a mobile phone number or mobile phone account of a user, sends a payment authorization request text message to the mobile phone requesting payment authorization, and receives a payment authorization text message from the mobile phone authorizing or not authorizing the payment. If the payment is authorized, the payment processor pays the merchant and charges the mobile phone account for the payment. If the payment is not authorized or if the payment is not received within a predetermined period of time, the payment processor declines to pay the merchant for the goods or services.

Owner:BOLORO GLOBAL LTD

System and method for using flexible circuitry in payment accessories

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

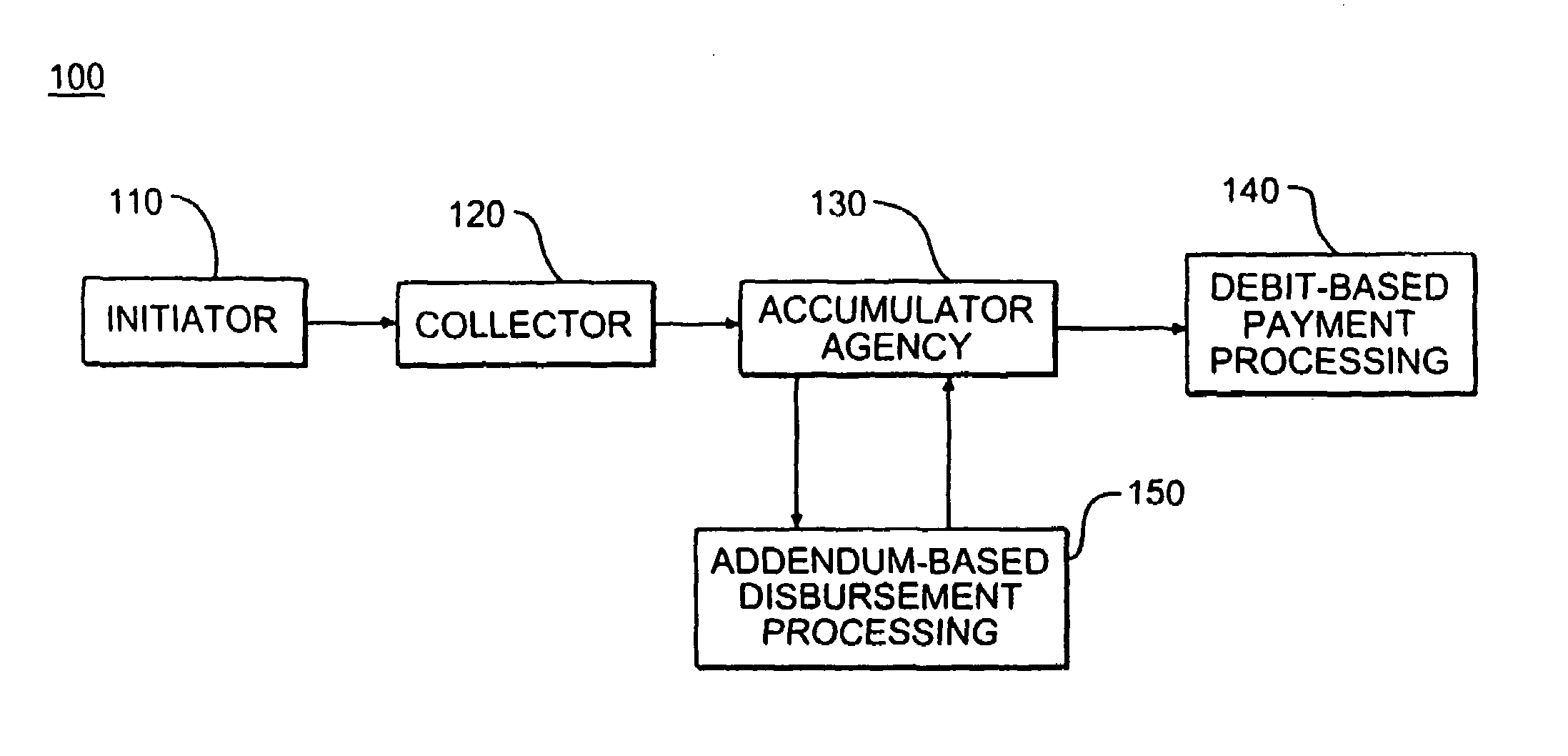

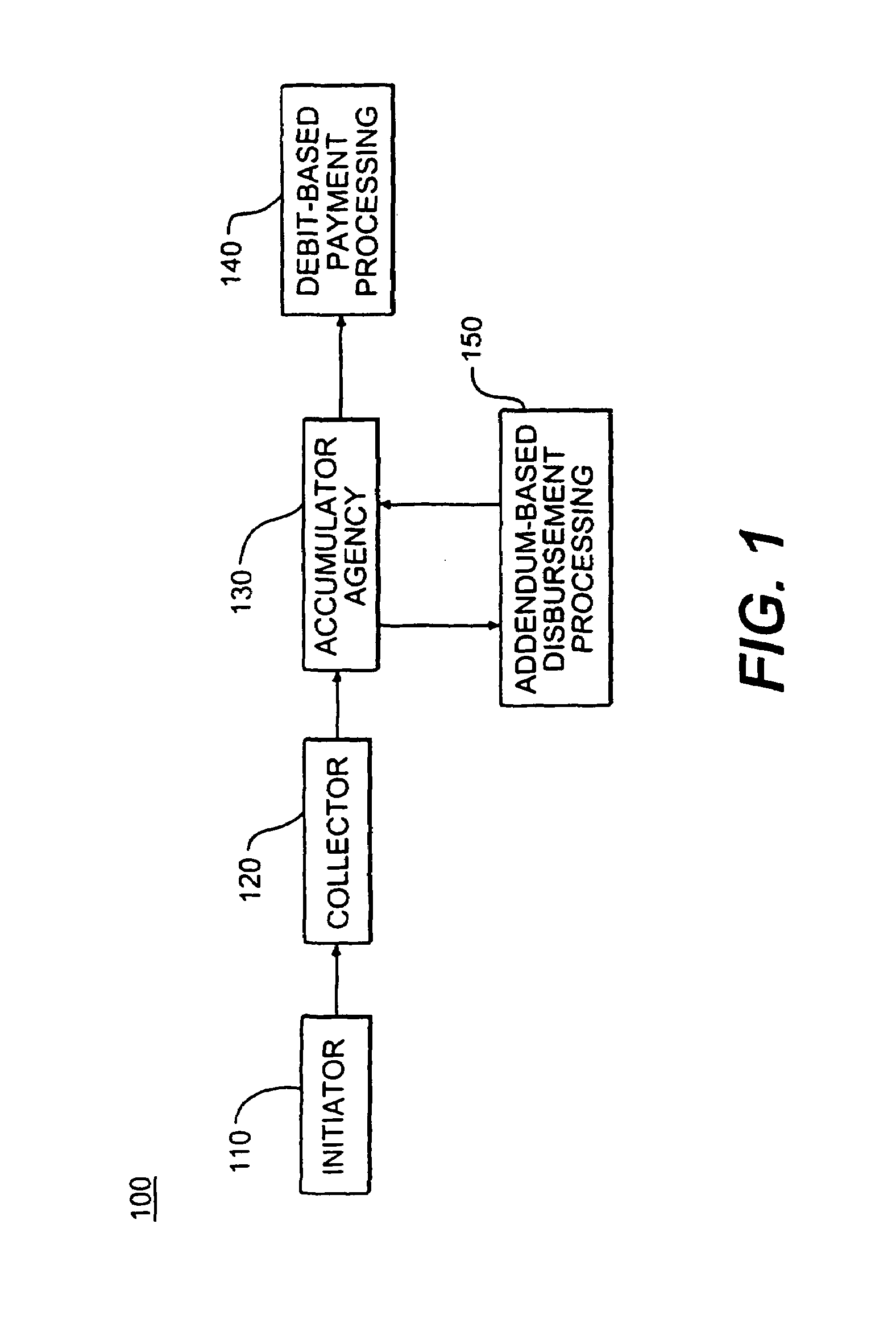

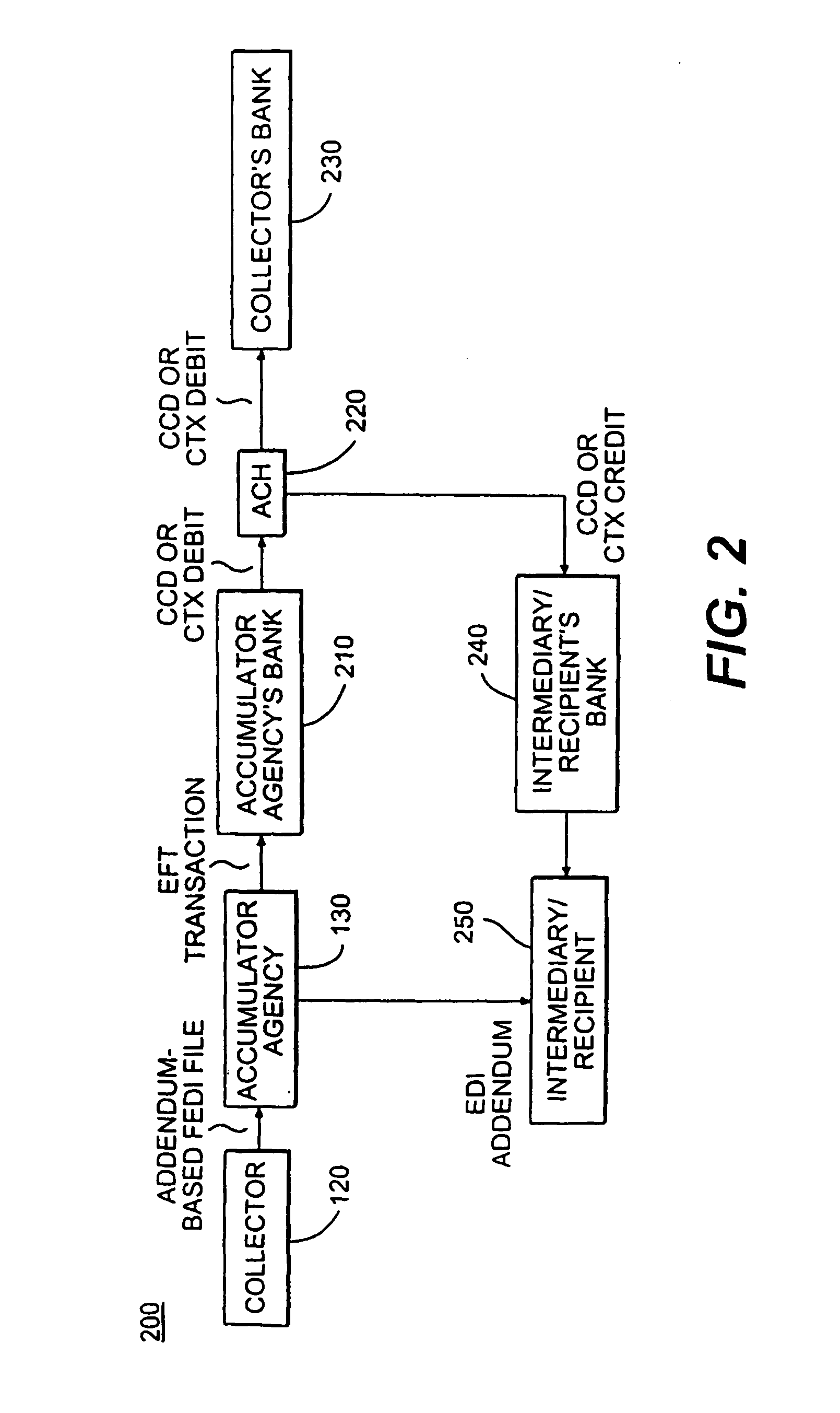

Method and apparatus for payment processing using debit-based electronic funds transfer and disbursement processing using addendum-based electronic data interchange

InactiveUS7225155B1Easy to processFinanceDigital data processing detailsEFTSElectronic funds transfer

This disclosure describes a payment and disbursement system, wherein an initiator authorizes a payment and disbursement to a collector and the collector processes the payment and disbursement through an accumulator agency. The accumulator agency processes the payment as a debit-based transaction and processes the disbursement as an addendum-based transaction. The processing of a debit-based transaction generally occurs by electronic funds transfer (EFT) or by financial electronic data interchange (FEDI). The processing of an addendum-based transaction generally occurs by electronic data interchange (EDI).

Owner:ACS STATE & LOCAL SOLUTIONS

Smartphone virtual payment card

A payment device presents a matrix barcode on a smartphone display screen for scanning by a merchant at a point-of-sale terminal. The consumer authenticates with their payment processor by logging in with their smartphone through a back channel. A successful log-in is rewarded with a matrix barcode the consumer can allow the merchant to scan if the particulars and price of the proposed transaction are acceptable. A transaction summary and request for approval arrive back at the consumer's smartphone through the back channel. Approval can be indicated by the entry of a user PIN code, and the transaction is complete.

Owner:CRYPTITE LLC

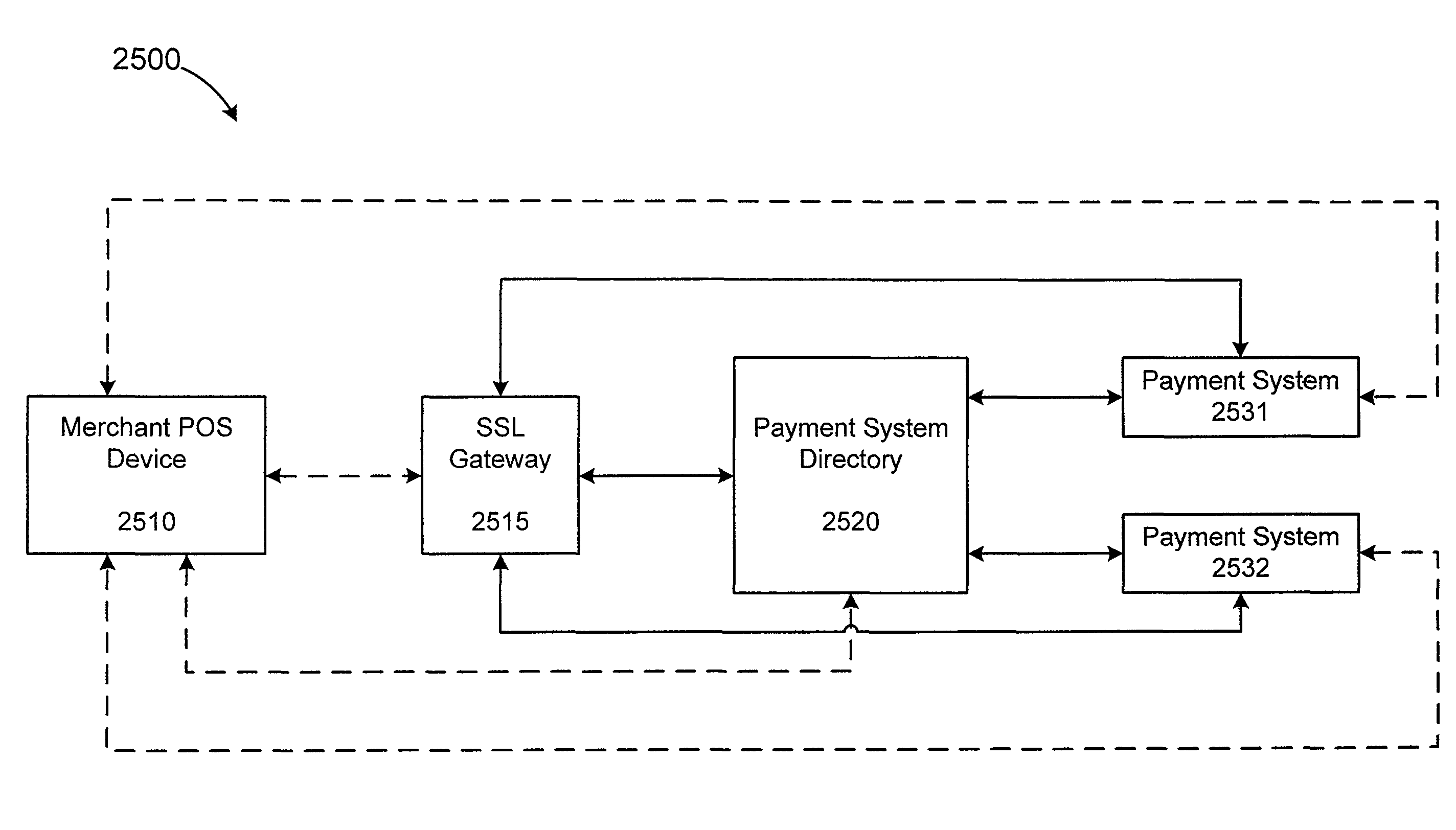

Methods for Processing a Payment Authorization Request Utilizing a Network of Point of Sale Devices

InactiveUS20090164327A1Easy to identifyEasy to calculateHand manipulated computer devicesFinanceThird partyIssuing bank

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

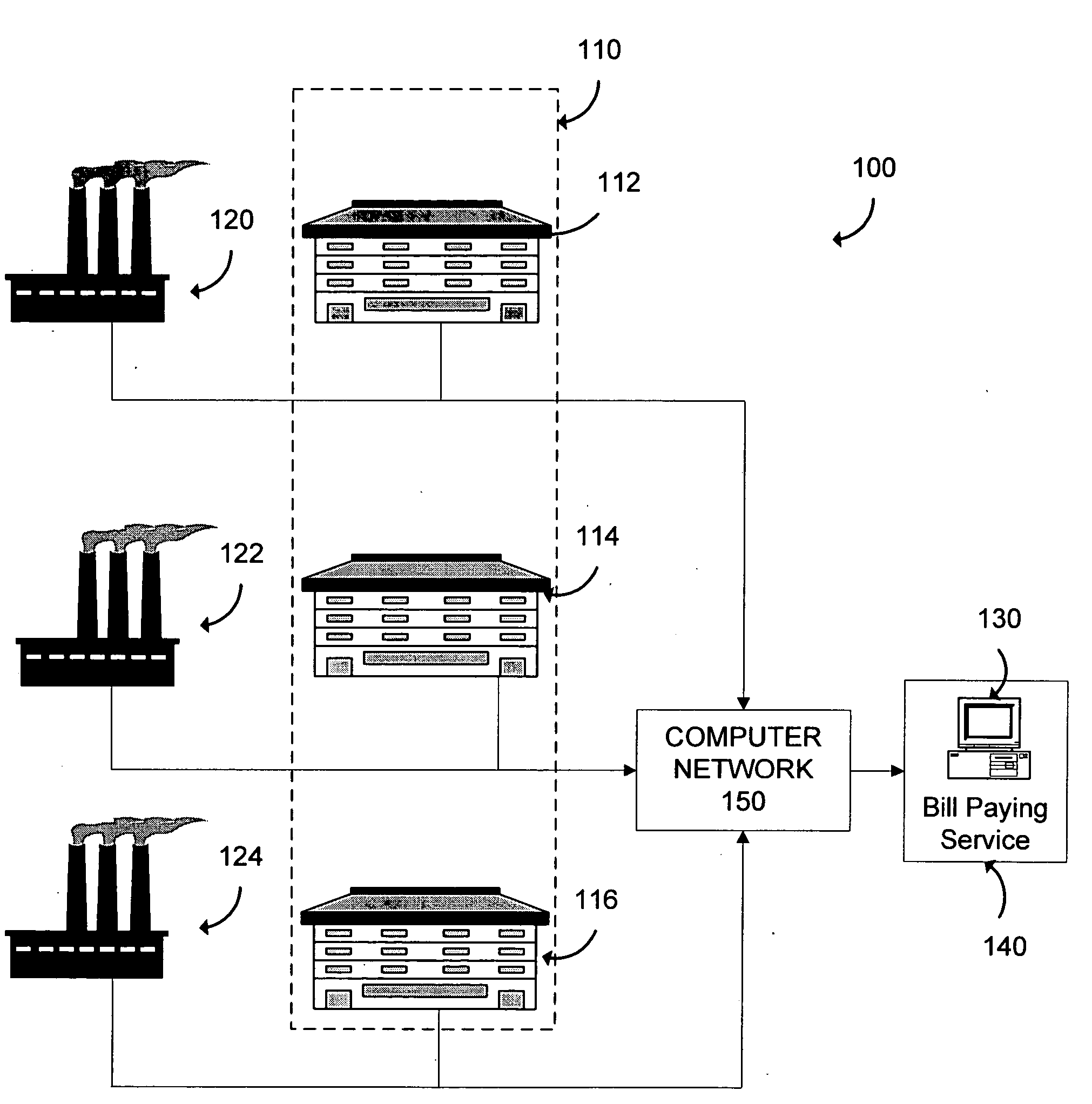

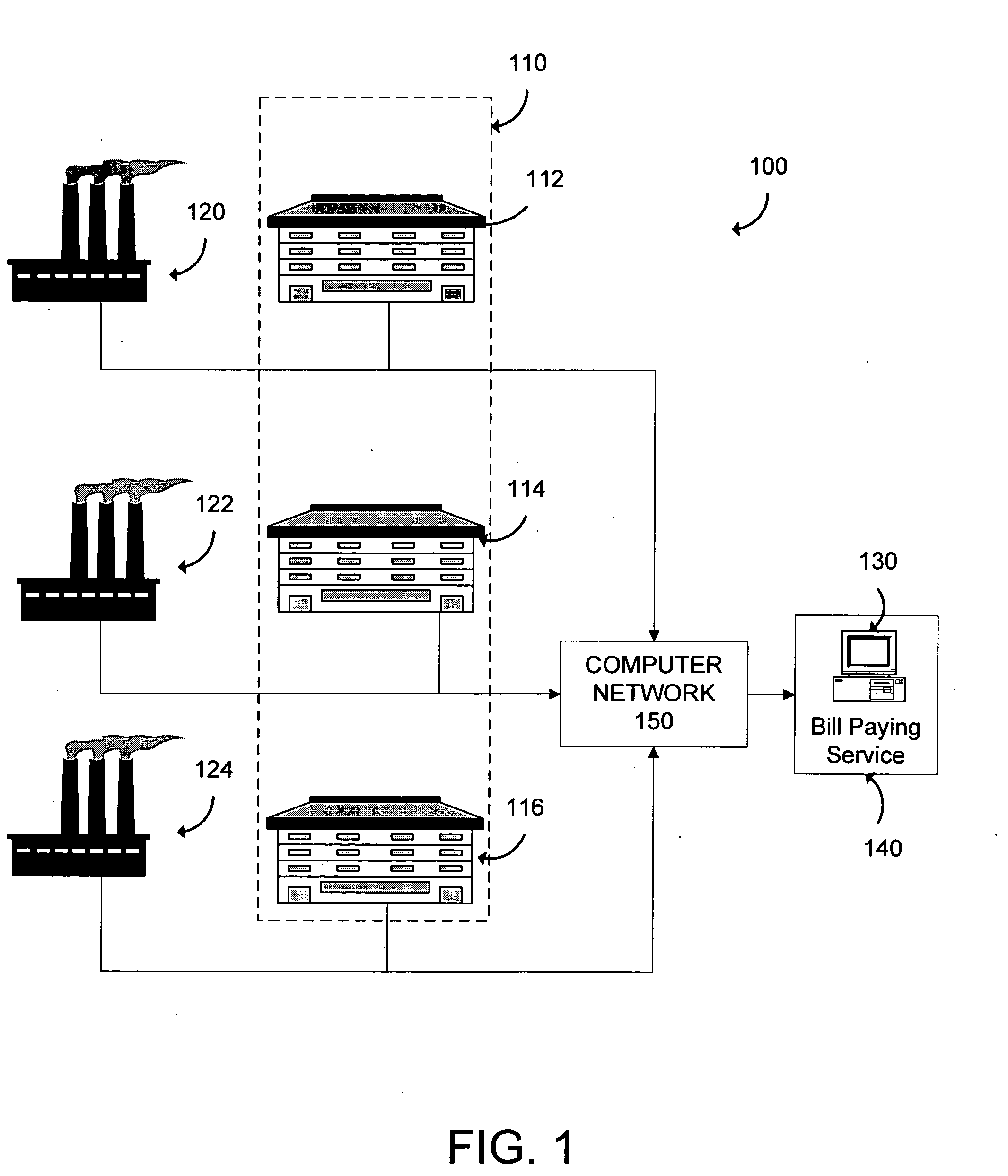

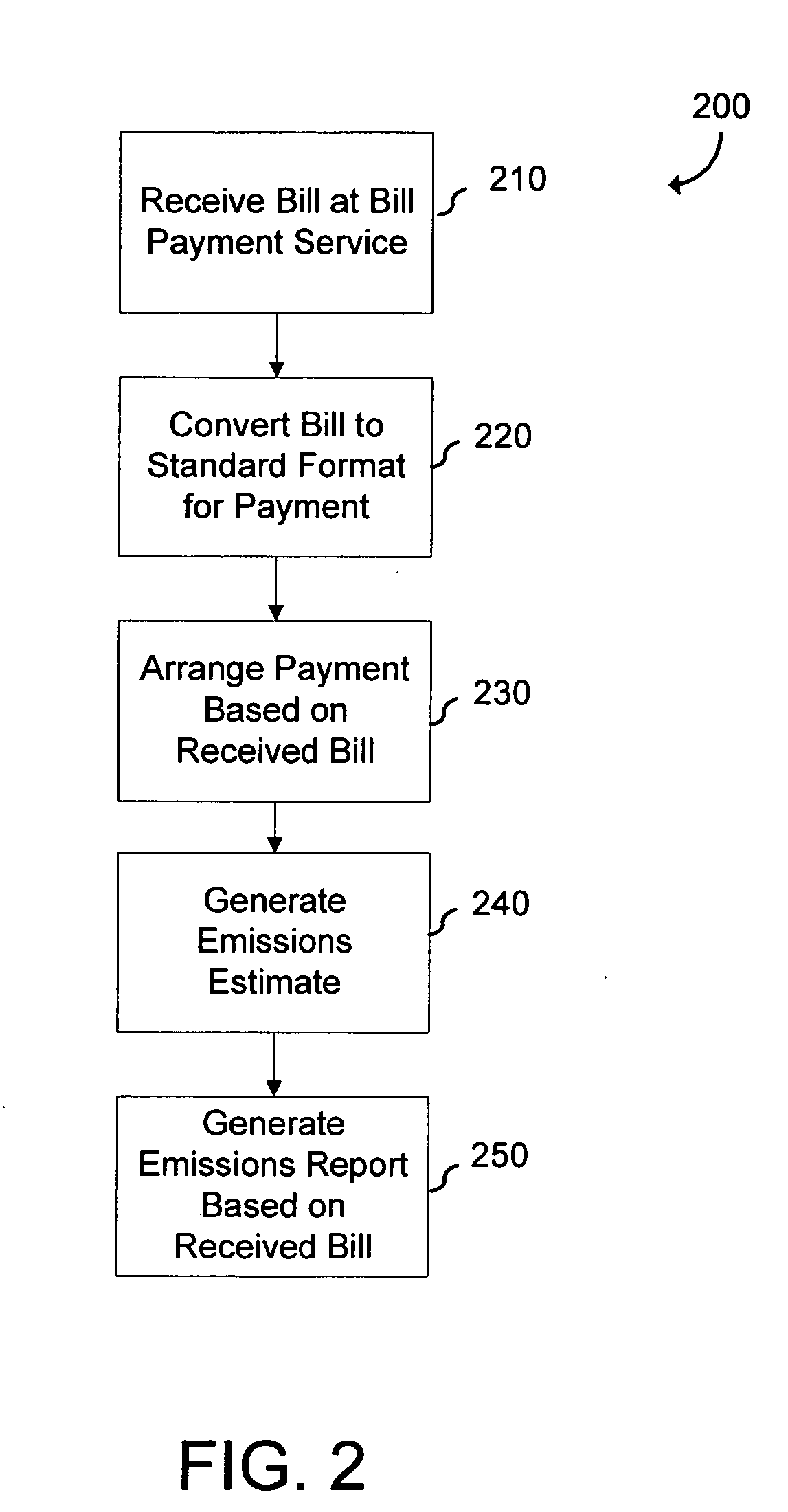

System and method for tracking emissions

A system for estimating emissions based on bills paid through a bill paying service. The system includes a bill payment processor configured to receive a bill for an external entity and arrange for a payment based on the bill, an emission estimation engine configured to generate an emissions estimate based on the bill, and a reporting engine configured to provide the emission estimate.

Owner:JOHNSON CONTROLS TECH CO

Systems and Methods for Allocating a Payment Authorization Request to a Payment Processor

InactiveUS20090157518A1Easy to identifyEasy to calculateHand manipulated computer devicesFinanceThird partyIssuing bank

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

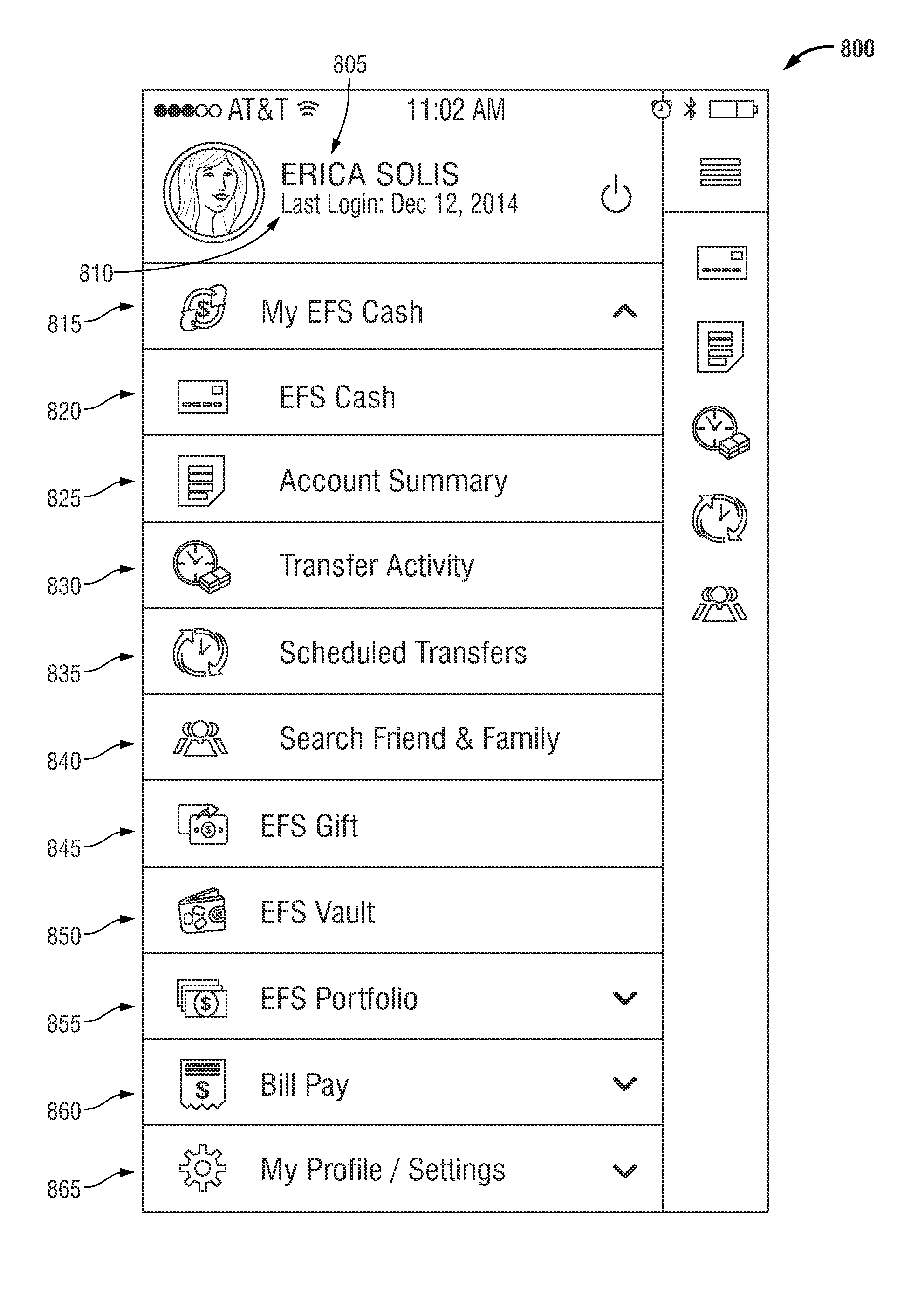

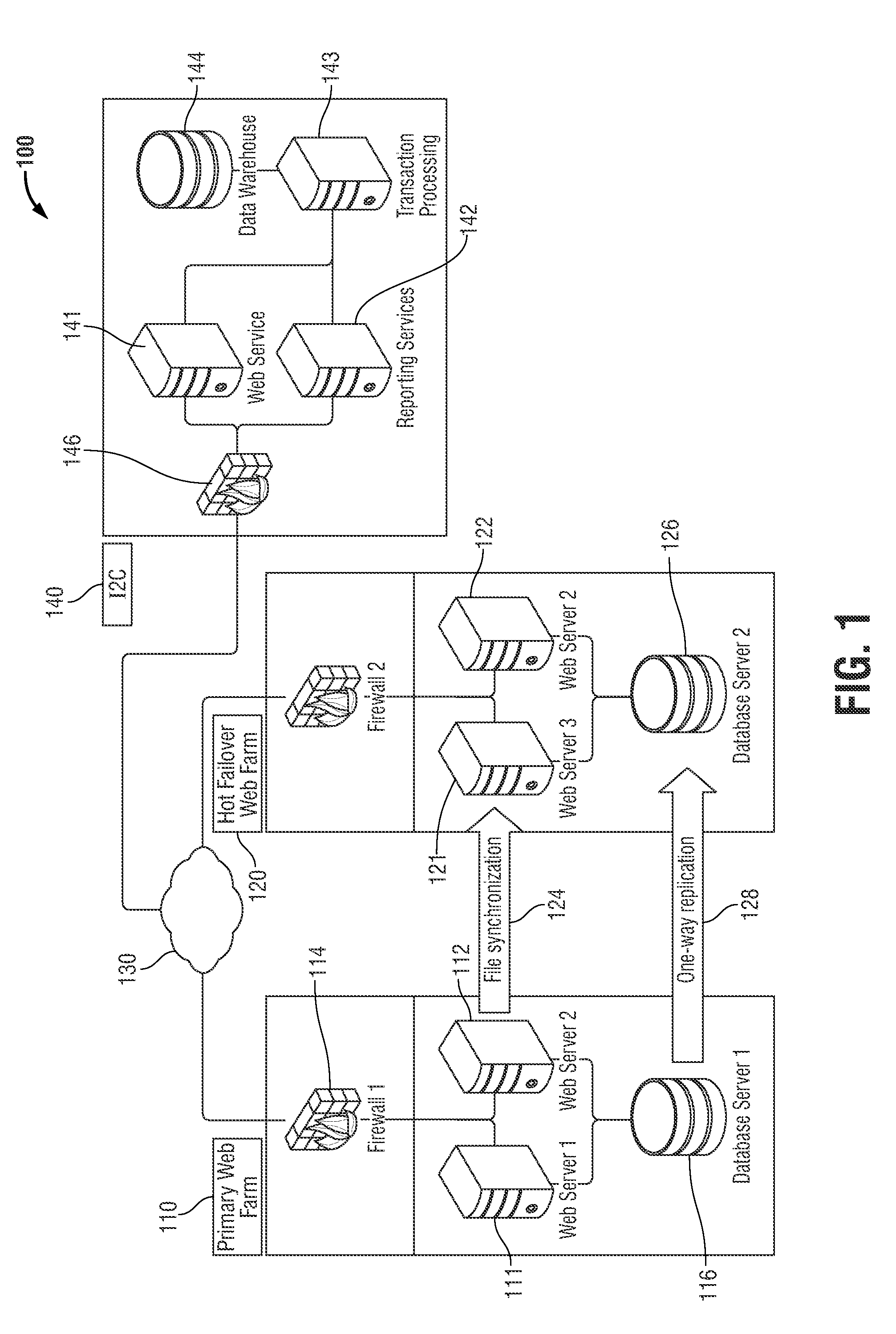

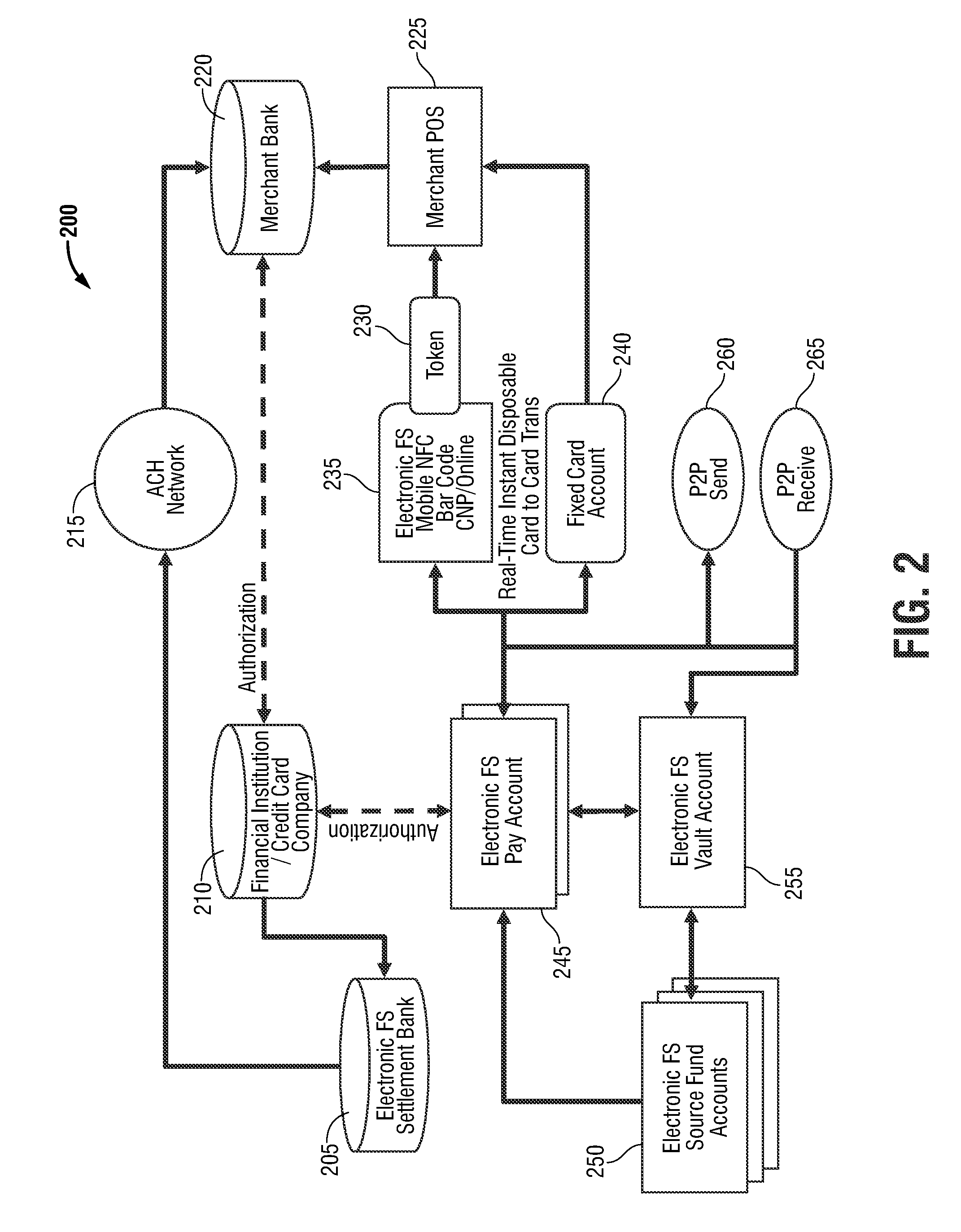

Financial services ecosystem

ActiveUS20150178693A1Capable of operatingComplete banking machinesFinanceCredit cardApplication software

A financial services ecosystem for providing a collaborative worldwide payment system includes: a computer-based system configured to credit a merchant, by way of a merchant bank, for goods sold or services rendered to a consumer; and a payment process platform configured to receive data from a user application. The payment process platform is configured to generate a disposable bank identification number (BIN). The disposable BIN is converted from a BIN issued by a financial institution or credit card company. The disposable BIN is used by a biller as an authorization BIN to document that the consumer has paid a bill.

Owner:MOVOCASH INC

Push Payment Processor

InactiveUS20140081783A1Hand manipulated computer devicesPoint-of-sale network systemsTransaction processing systemAuthorization

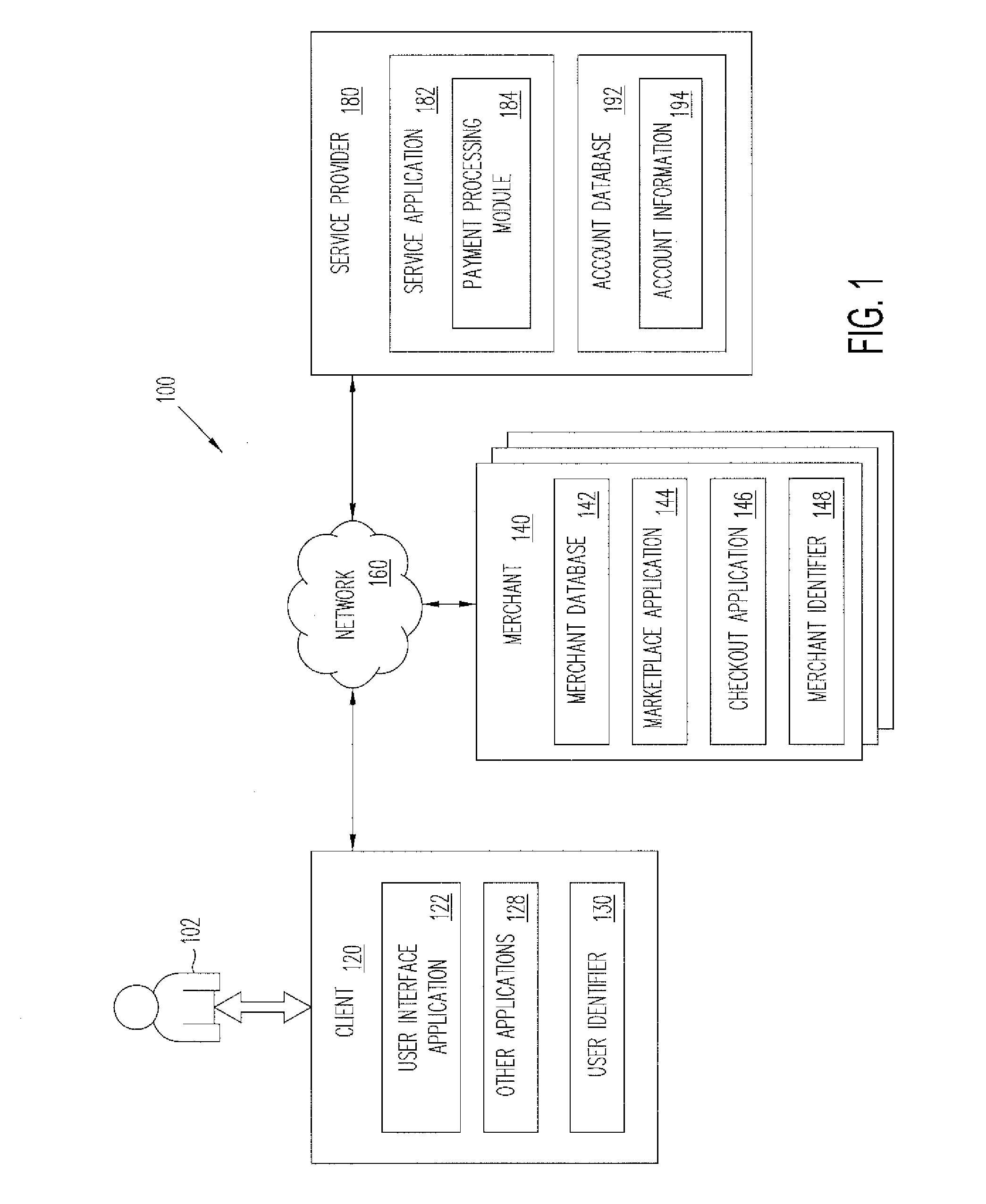

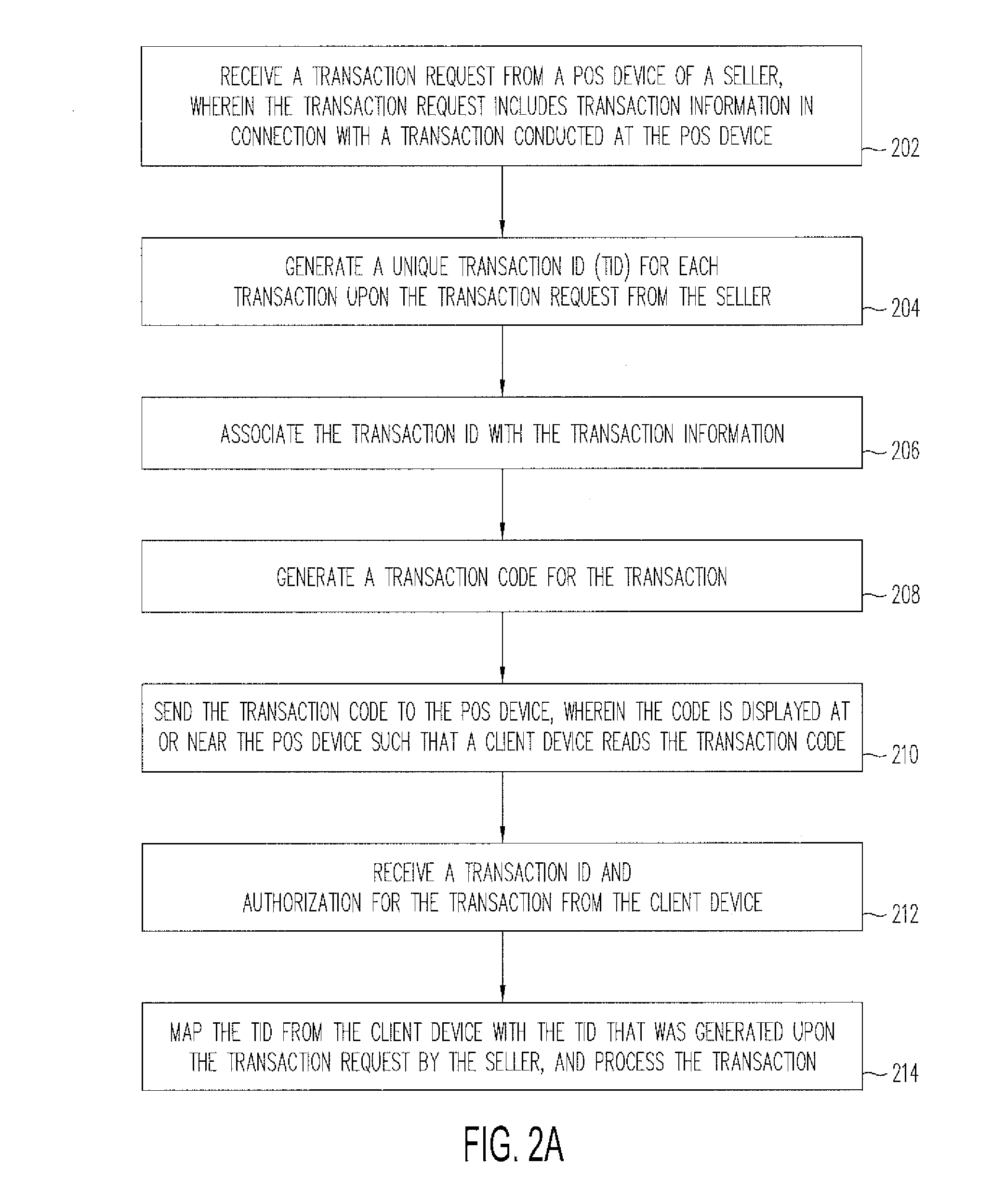

Embodiments of methods and systems provide transaction processing with dynamic generated codes. In an embodiment, a system comprises a remote server adapted to interact with a POS device and a client device; one or more processors; and one or more memories adapted to store machine-readable instructions to cause the system to: receive, by the server at the remote location, a transaction request from the POS device of the seller, wherein the transaction request includes transaction information in connection with a transaction conducted at the POS device; generate a transaction code upon receiving the transaction request from the POS device, wherein the transaction code includes the transaction information; send the transaction code to the POS device; receive an authorization request for the transaction from the client device after the client device reads the transaction code from the POS device; and process the transaction.

Owner:PAYPAL INC

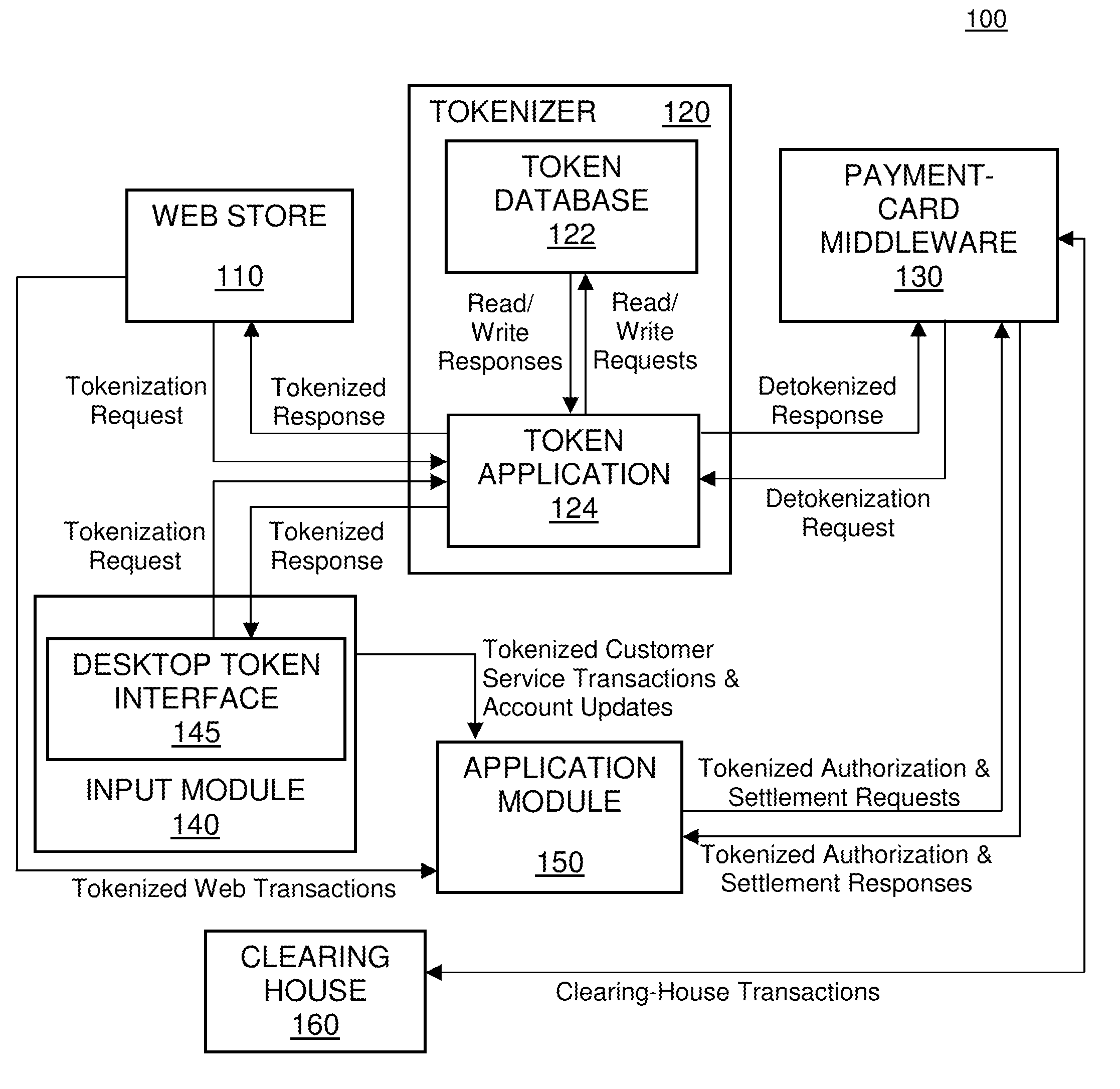

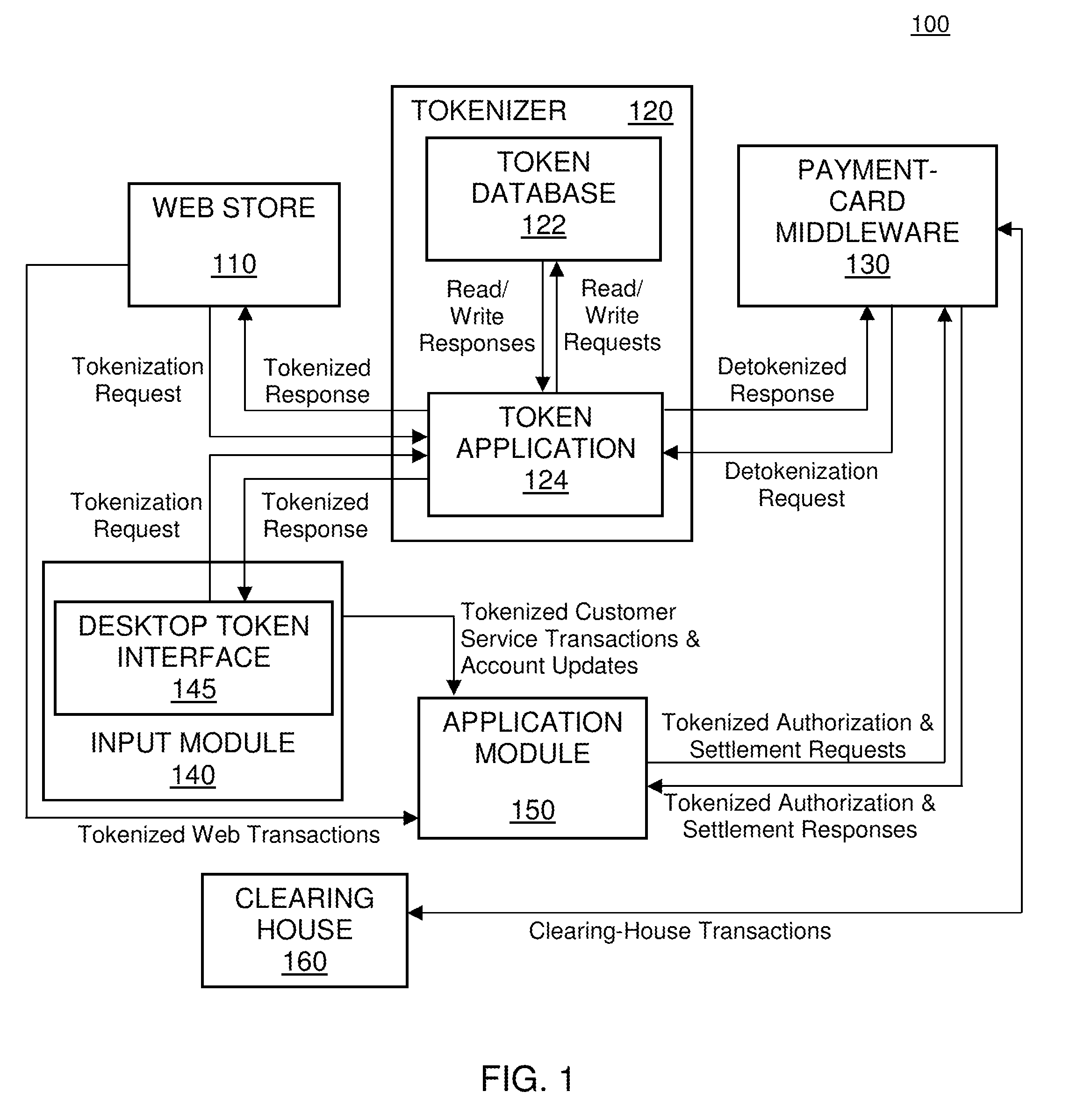

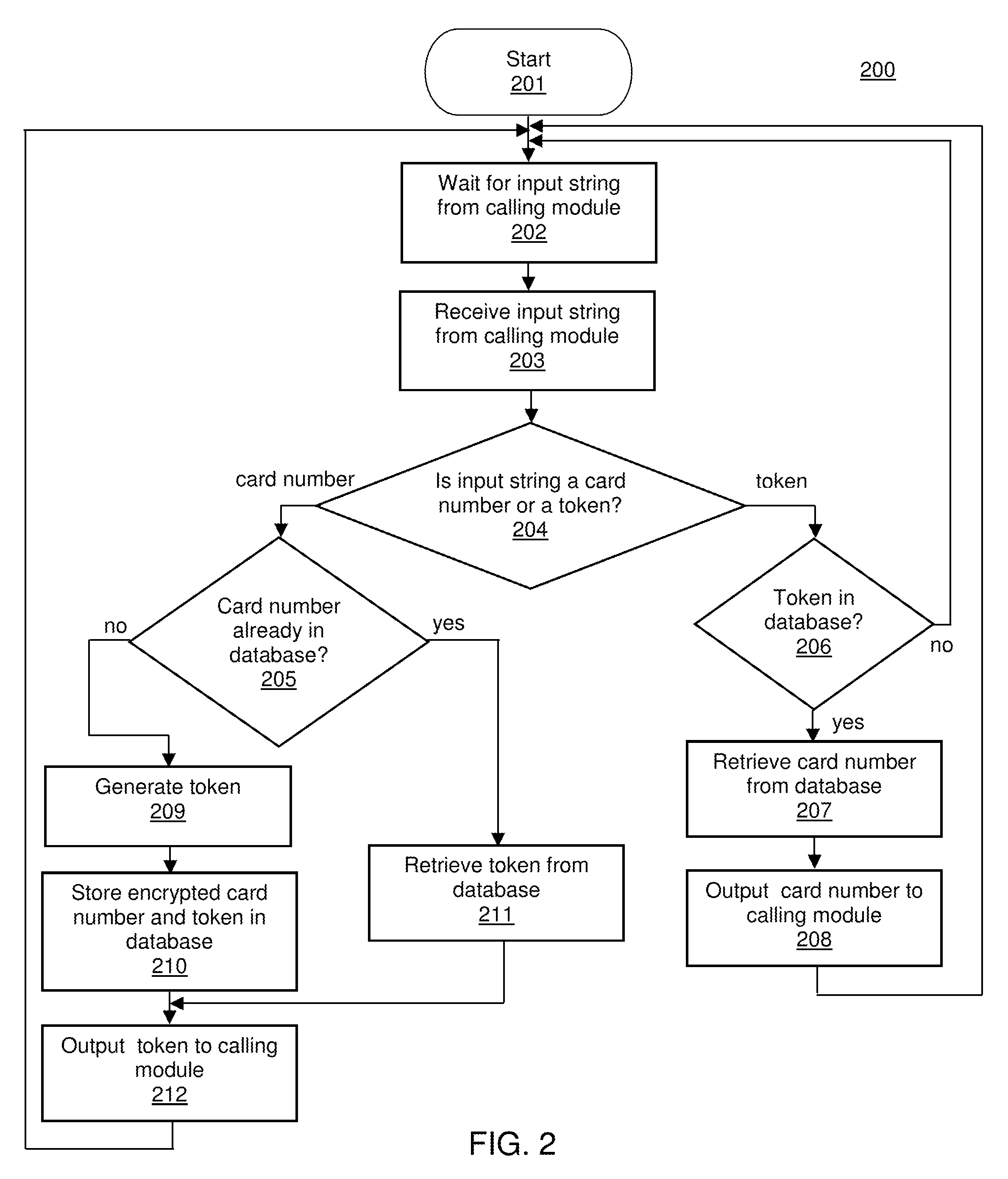

Token-based payment processing system

InactiveUS20100257612A1Avoid spreadingDigital data processing detailsAnalogue secracy/subscription systemsData processing systemInternet privacy

A data-processing system, such as a payment processing system, including a tokenizer, such as a card encryption and storage system (CES) employing a tokenization feature. In one embodiment, the present invention provides a first-computer-implemented method for preventing the transmission of confidential information between a first computer and a second computer in communication with the first computer. The method includes the steps of: (a) the first computer receiving information for performing a transaction, the information including confidential information manually entered by a user; (b) the first computer sending the confidential information to a third computer; (c) the first computer receiving, from the third computer, a token having no algorithmic relationship to the confidential information; and (d) the first computer sending to the second computer (i) the information for performing the transaction, except for the confidential information, and (ii) the token.

Owner:CARDCONNECT LLC

Methods for a third party biller to receive an allocated payment authorization request

InactiveUS8820633B2Easy to identifyEasy to calculateComplete banking machinesHand manipulated computer devicesThird partyIssuing bank

Owner:LIBERTY PEAK VENTURES LLC

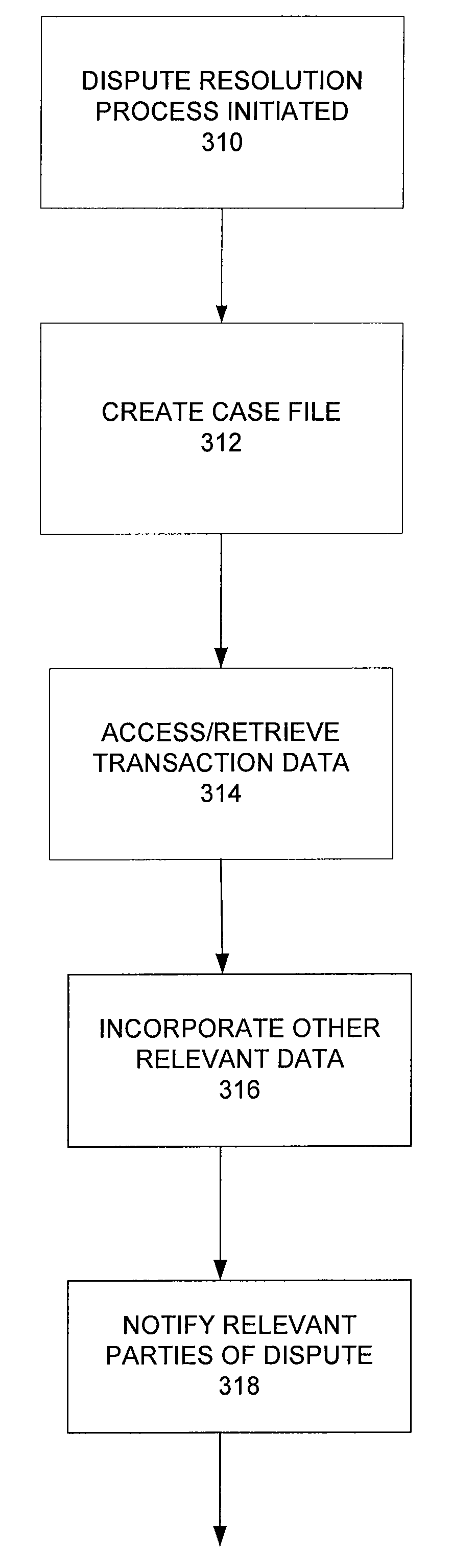

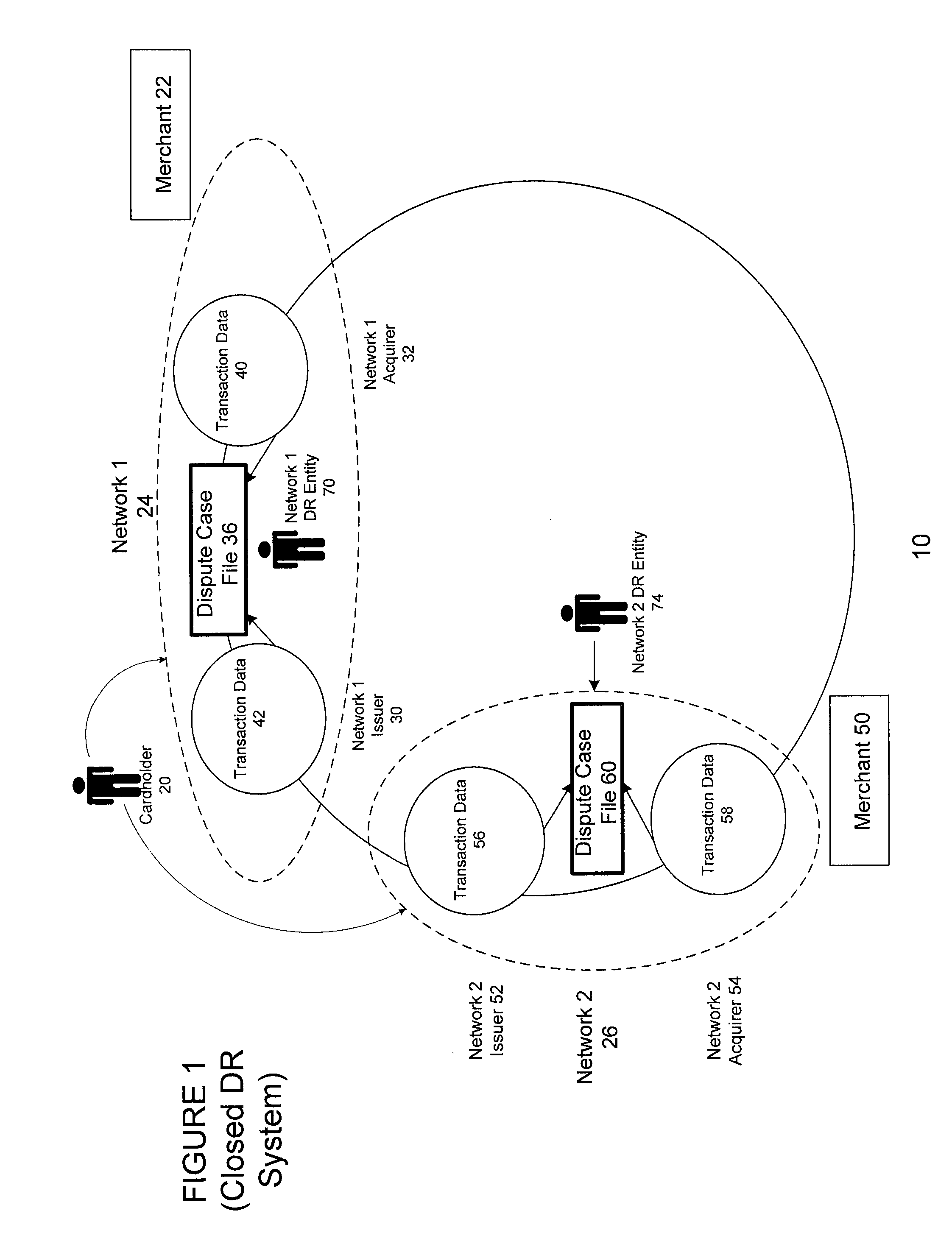

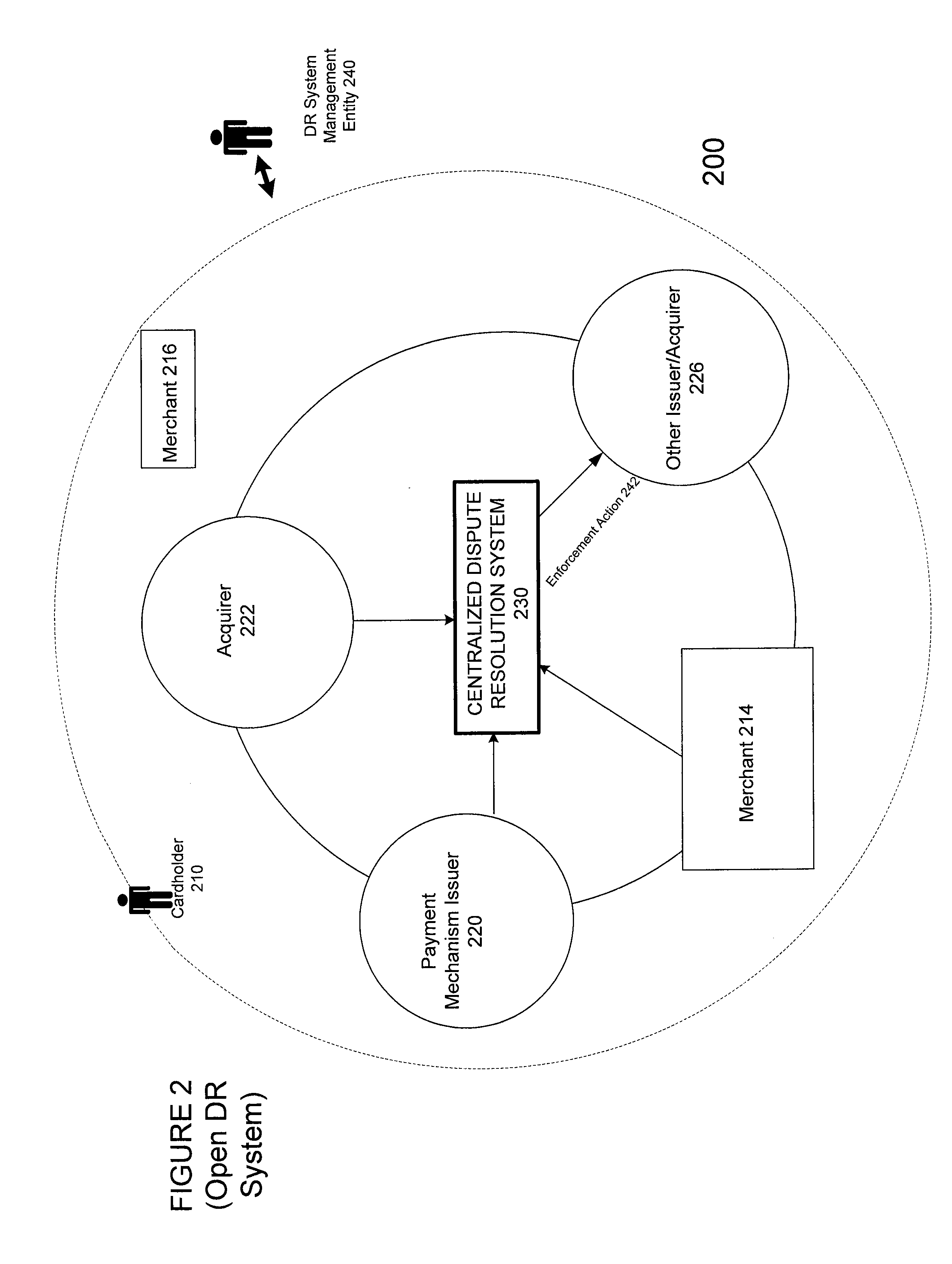

Centralized dispute resolution system for commercial transactions

InactiveUS20090030710A1Raise the possibilityReduce incentivesFinanceCredit schemesComputer data storageClient-side

A centralized dispute resolution system for use in commercial credit or debit card transactions. The inventive system utilizes a common data storage, interfaces, processes, procedures, rules, and other elements of a dispute resolution system that are made available to cardholders, merchants, card issuers, payment processors, and other parties that may be involved in a dispute or in a process intended to resolve a dispute. The system may be implemented using a client-server architecture with communication between clients and one or more server elements provided by a communications network.

Owner:VISA USA INC (US)

Methods for locating a payment system utilizing a point of sale device

InactiveUS20090164326A1Easy to identifyEasy to calculateComplete banking machinesHand manipulated computer devicesThird partyIssuing bank

A point of sale (POS) device may be configured to locate a payment system and transmit a payment authorization request from a remote location to a payment system, either directly, or via a payment system directory and / or a SSL Gateway. The invention also includes inserting third party account information into an encrypted portion of the payment request, so the payment request appears as a normal request to the issuing bank, but the third party account information may be used by the third party to bill the customer. The payment system directory is further configured to determine one or more payment processors to direct a payment authorization request, such that a single transaction may me allocated among multiple payment processors for authorization. Moreover, the payment system directory is able to format alternative payment methods into a format that is able to be processed over existing payment networks.

Owner:LIBERTY PEAK VENTURES LLC

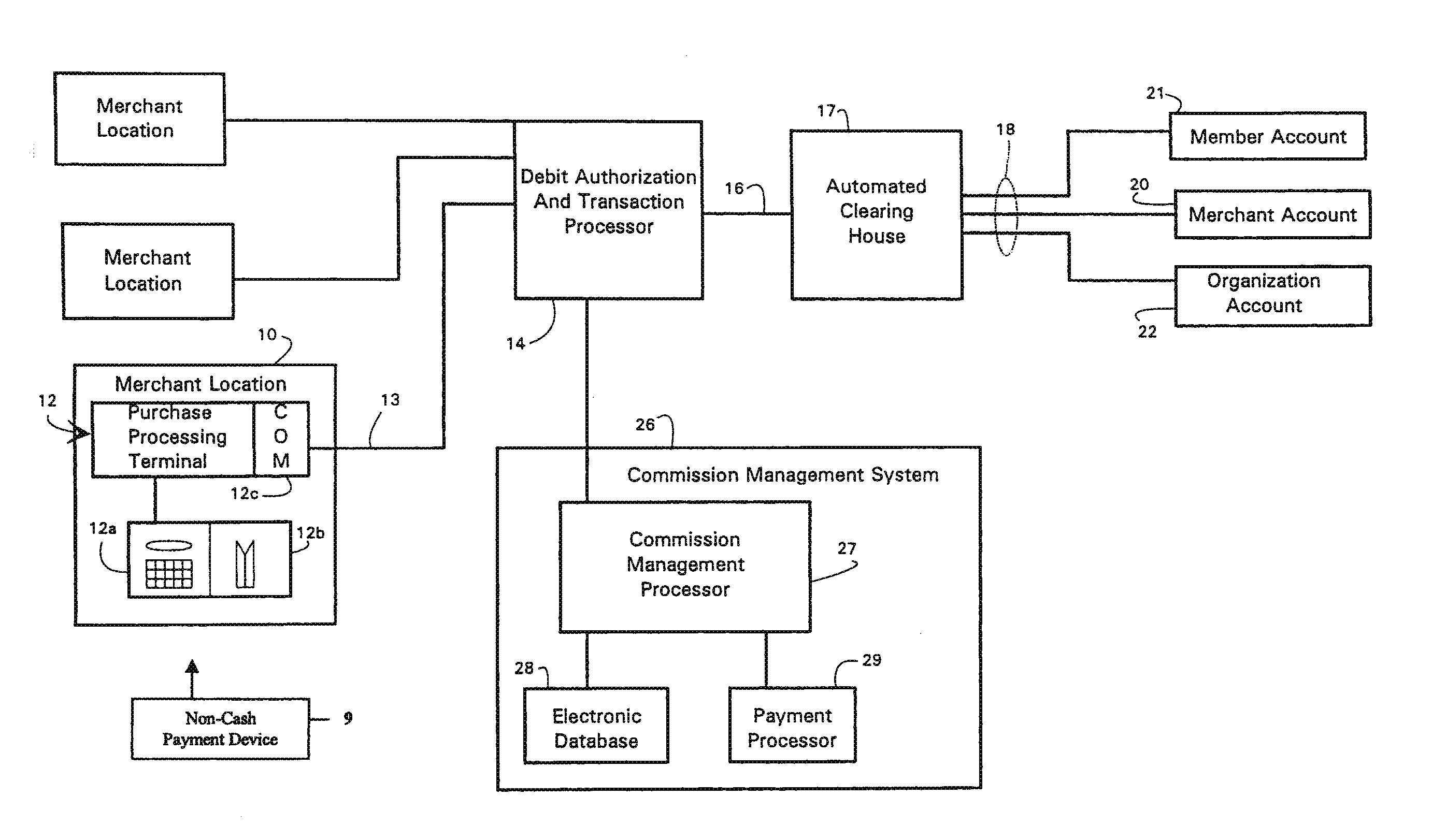

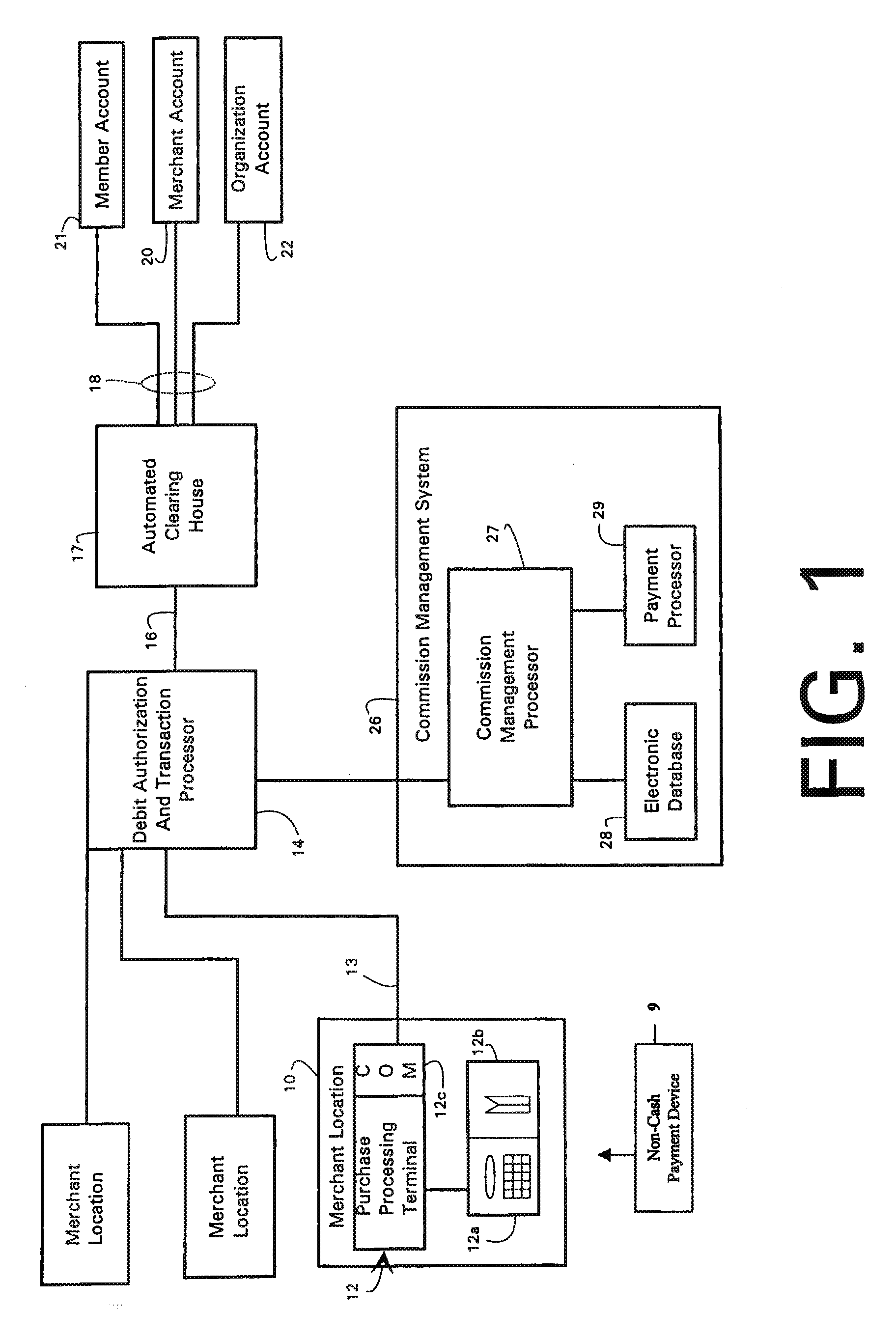

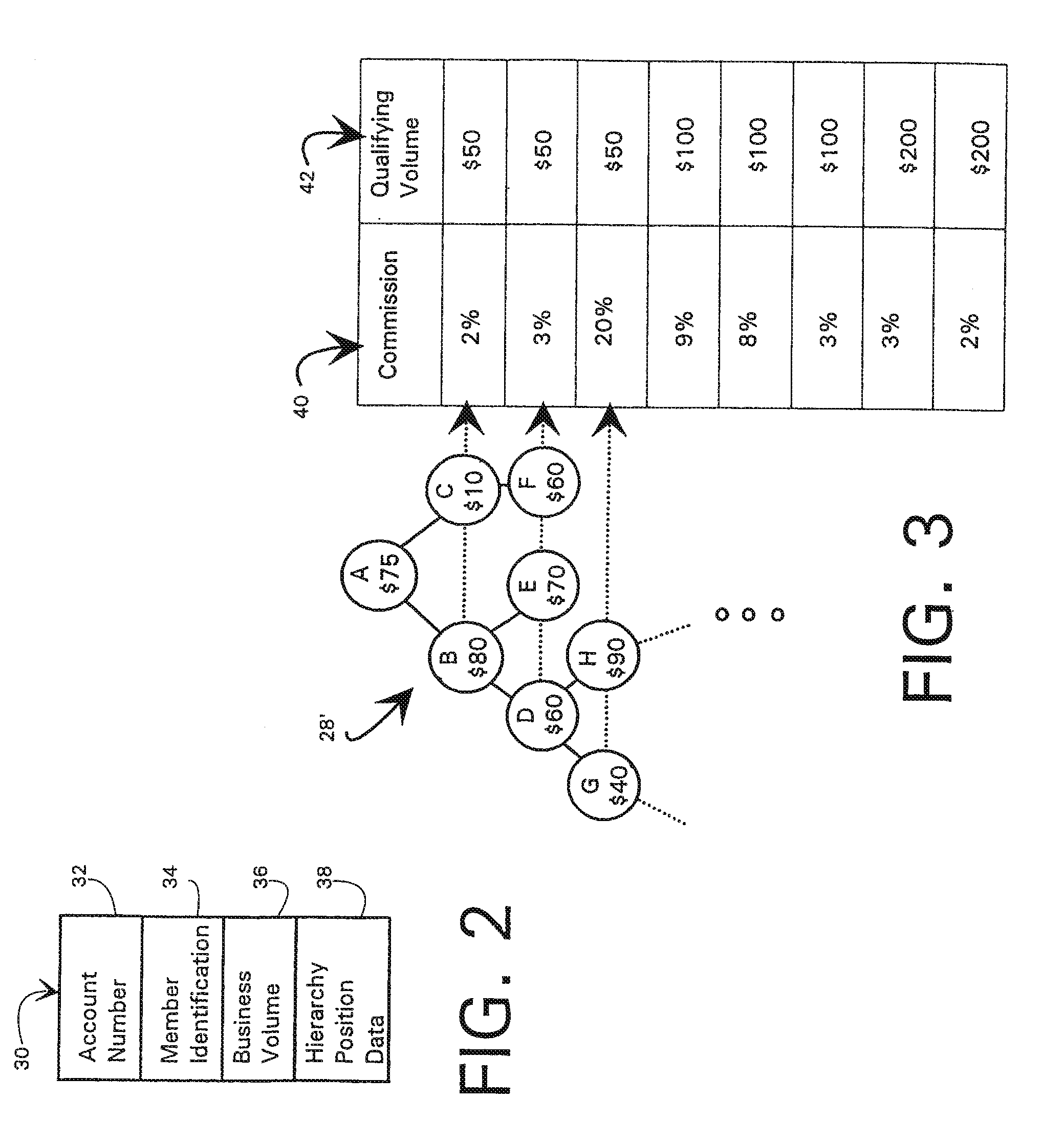

Non-cash transaction incentive and commission distribution system

InactiveUS20090216640A1Complete banking machinesDiscounts/incentivesNetwork structureDistribution system

An electronic fund transfer system is disclosed wherein commissions for point-of-sale purchase transactions are determined and distributed to members of an organizational network for promoting use of a non-cash payment device that is tangible for effecting purchase transactions. Purchase data is electronically transmitted from the point-of-sale to an automated clearing house for effecting fund transfers to prepare the purchase, and also to a commission management system. The commission management system maintains an electronic database reflecting the structure of the organizational network, and further determines the distribution of purchase commissions according to a predetermined schedule of proportions relating to the position and business volume of each member of the network. The commission management system further comprises a payment processor for effecting commission payments to the members or to a designated sponsor on a scheduled basis.

Owner:MASI LARRY A

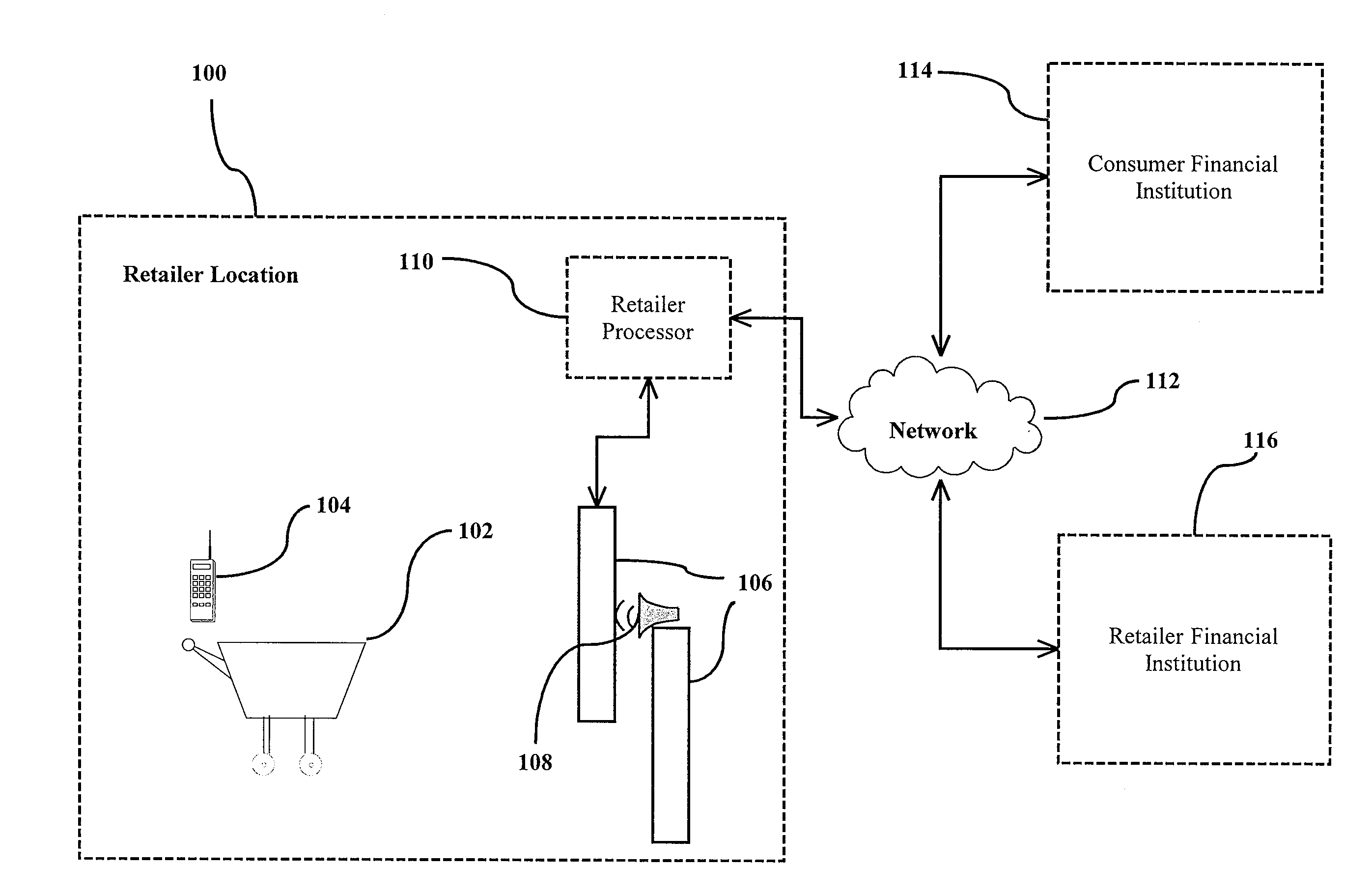

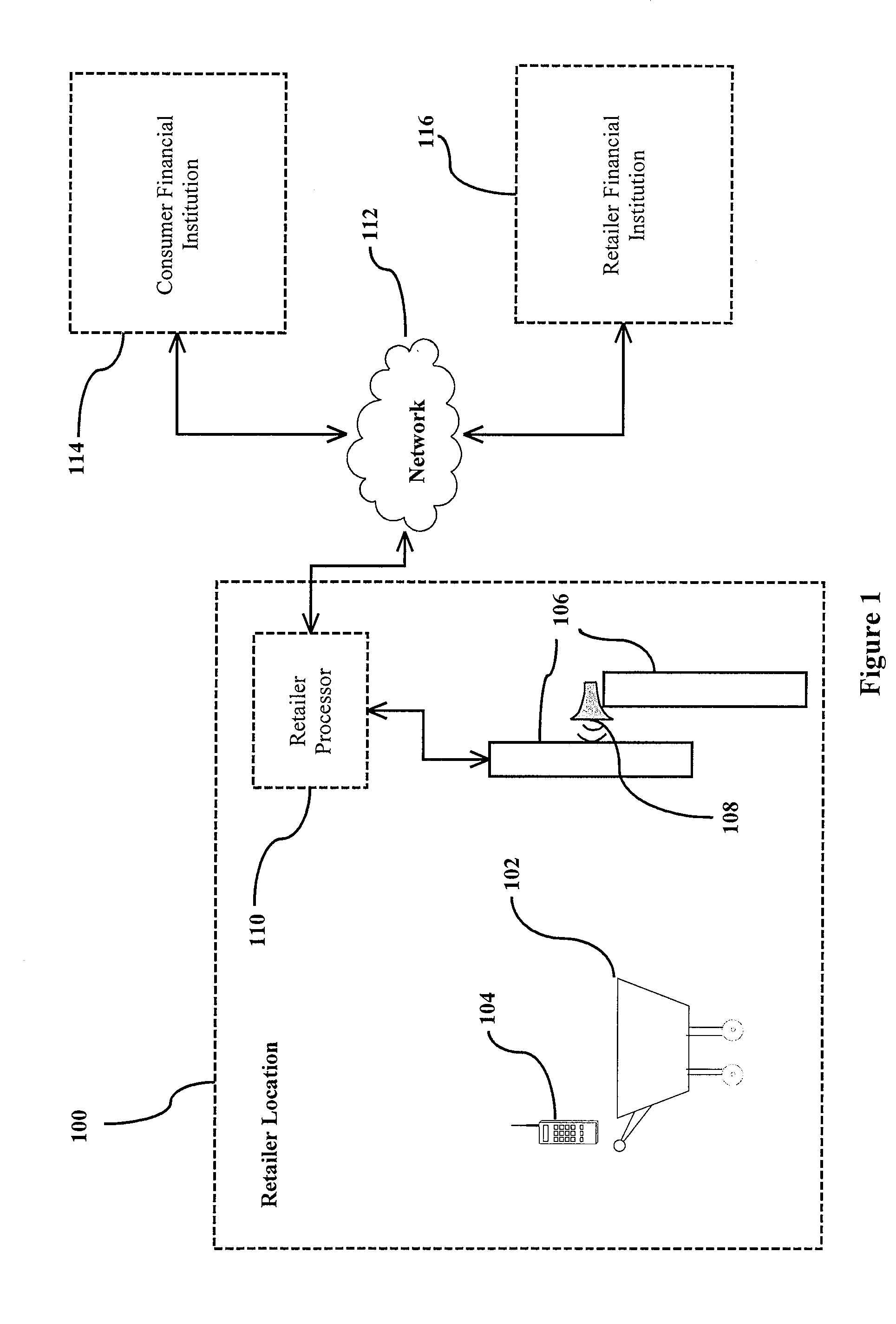

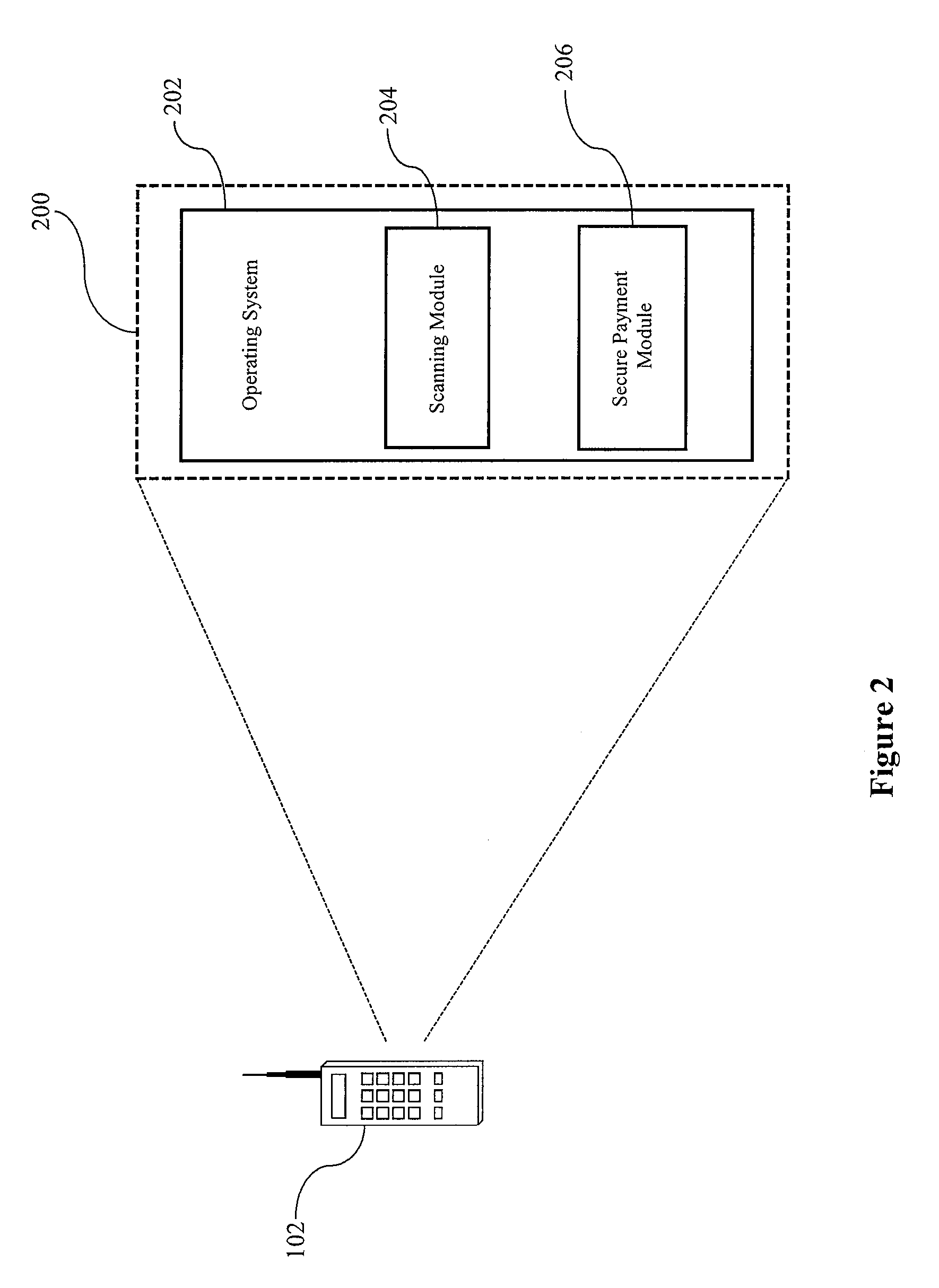

Complete Secure Retail Transaction Via A Mobile Device

InactiveUS20090055278A1Simplify the payment processSpecial service for subscribersPayment architectureOperational systemMobile device

The present invention incorporates scanning technology and secure payment technology into the operating system (OS) of a mobile device such as a smartphone. In a preferred embodiment, the scanning technology comprises RFID interrogation capability. This enables smartphone users to validate transactions during a shopping session at a retail location (i.e., scan items as they are added to their shopping cart) and streamline the payment process by electronically transmitting their credit / debit card information directly to their financial institution to authorize payment to finish the transaction, all while within the retail location.

Owner:SYMBIAN SOFTWARE LTD

Payment processing utilizing alternate account identifiers

A technique for making a payment for a payor is provided. The technique includes receiving a request to make a payment to a payee for the payor. An account identifier which is associated with a deposit account belonging to the payee is identified based upon processing of the received payment request. The account identifier is not a deposit account number assigned to the deposit account by the financial institution at which the deposit account is maintained. A payment is then directed to the payee's deposit account utilizing the identified account identifier.

Owner:CHECKFREE SERVICES CORP

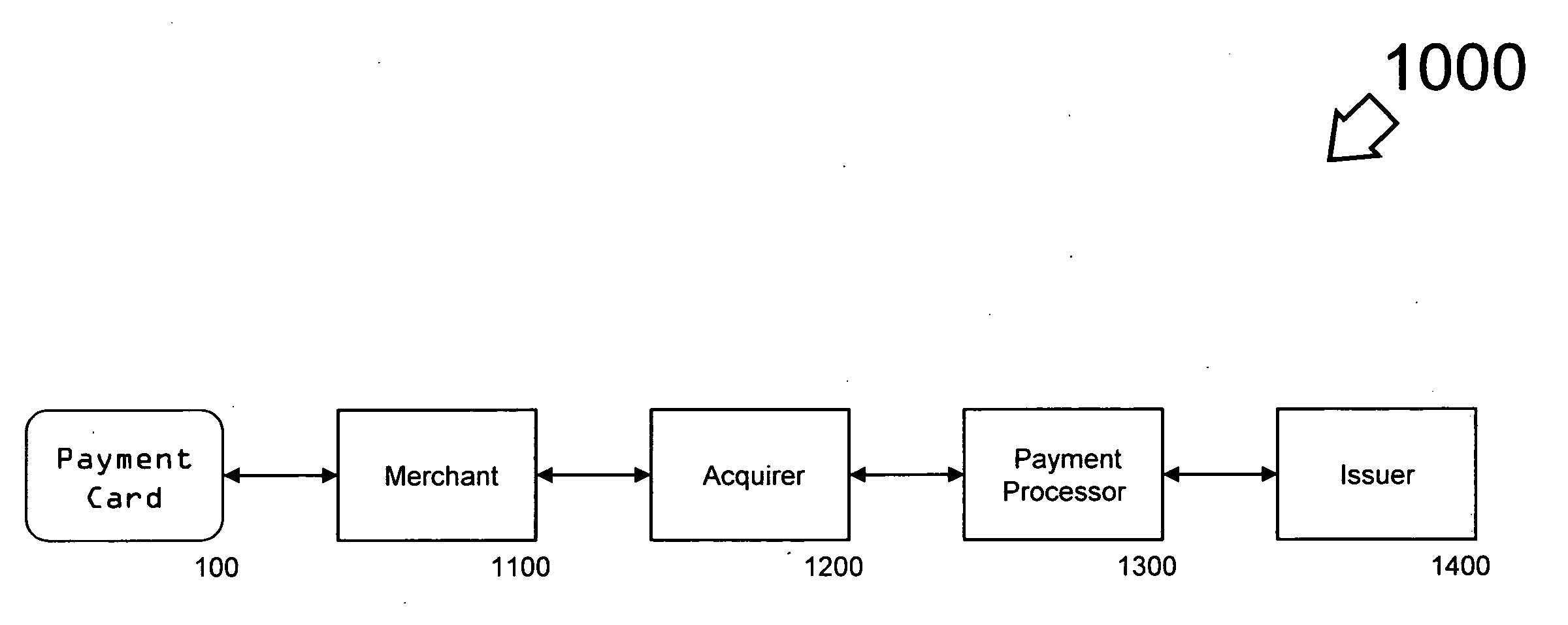

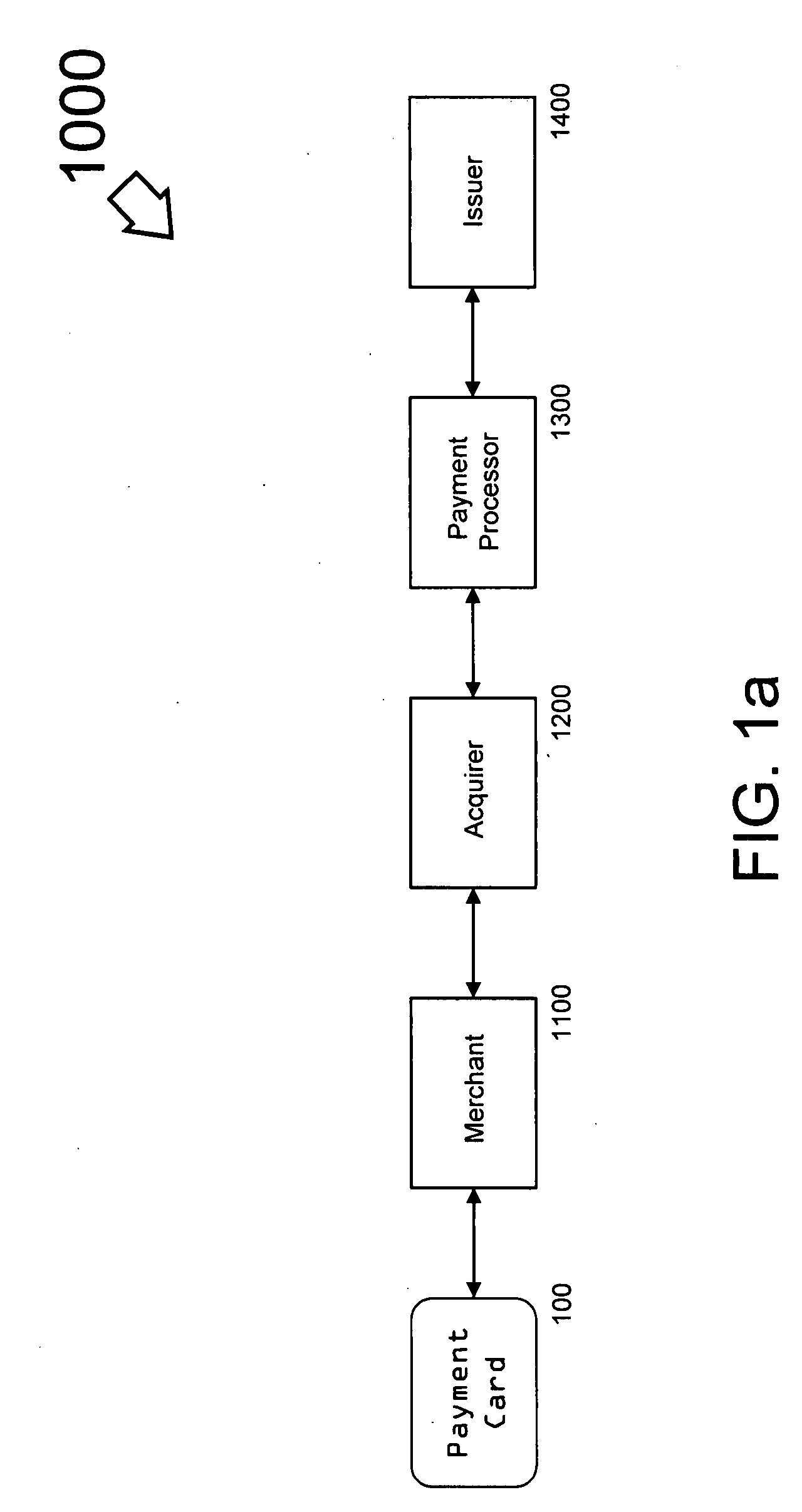

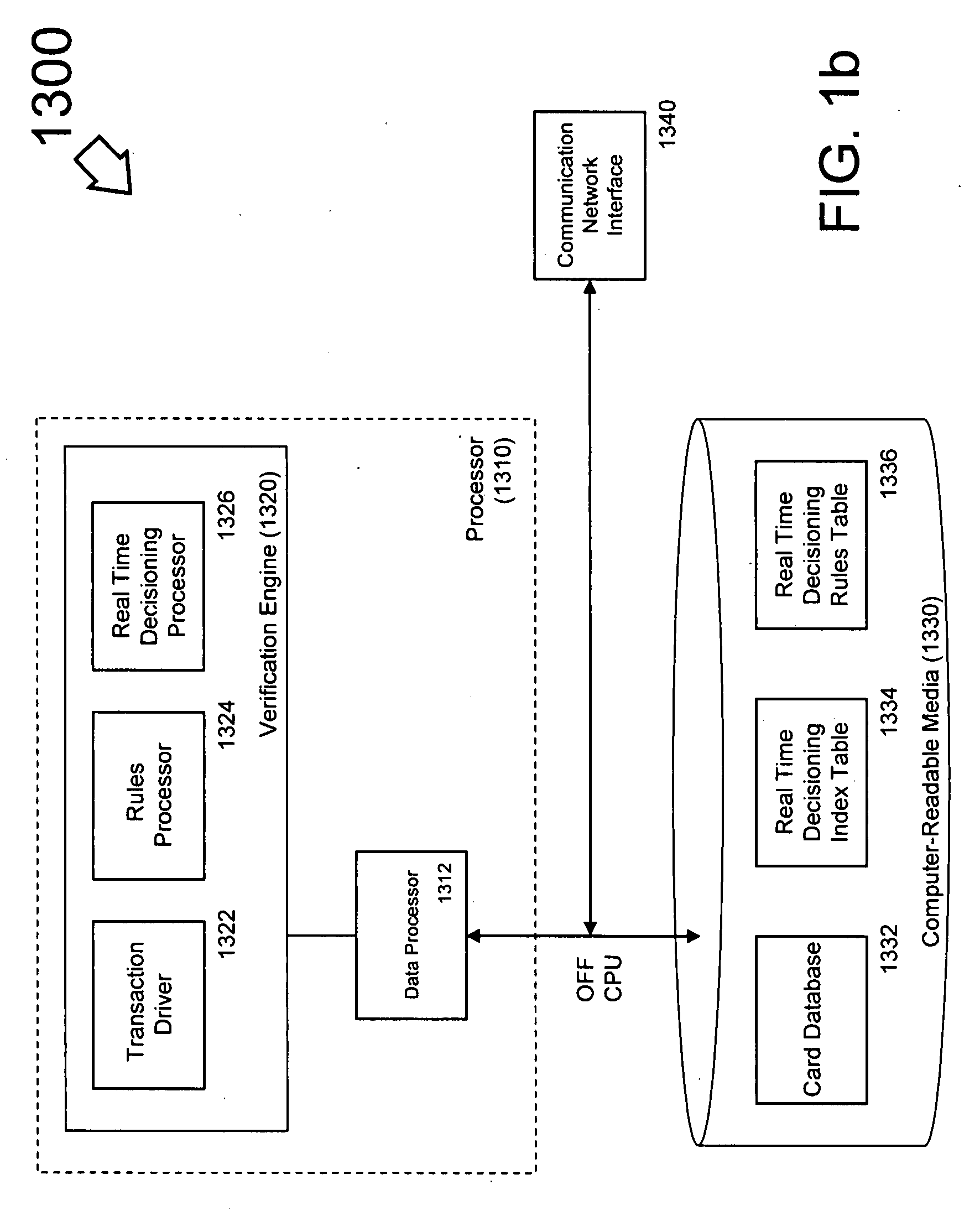

Fraud prevention based on risk assessment rule

A system, method, and computer-readable storage medium configured to import fraud prevention rules from an issuer and implement them in real-time at a payment processor. Usually, a card issuing bank either approves or declines financial transaction; however, in embodiments of the present invention, the issuing bank creates fraud prevention rules, and the payment processor implements the created rules. A payment processor apparatus comprises a network interface, and a verification engine. The verification engine includes a transaction driver, and a real time decisioning processor. The network interface is configured to receive a fraud prevention rule from a payment card issuing bank, and to receive a proposed financial transaction from an acquiring bank. The transaction driver receives the fraud prevention rule. The real time decisioning processor compares the proposed financial transaction from the acquirer and the fraud prevention rule to determine whether the proposed financial transaction should be declined.

Owner:VISA USA INC (US)

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com