Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

197 results about "Deposit account" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A deposit account is a savings account, current account or any other type of bank account that allows money to be deposited and withdrawn by the account holder. These transactions are recorded on the bank's books, and the resulting balance is recorded as a liability for the bank and represents the amount owed by the bank to the customer. Some banks may charge a fee for this service, while others may pay the customer interest on the funds deposited.

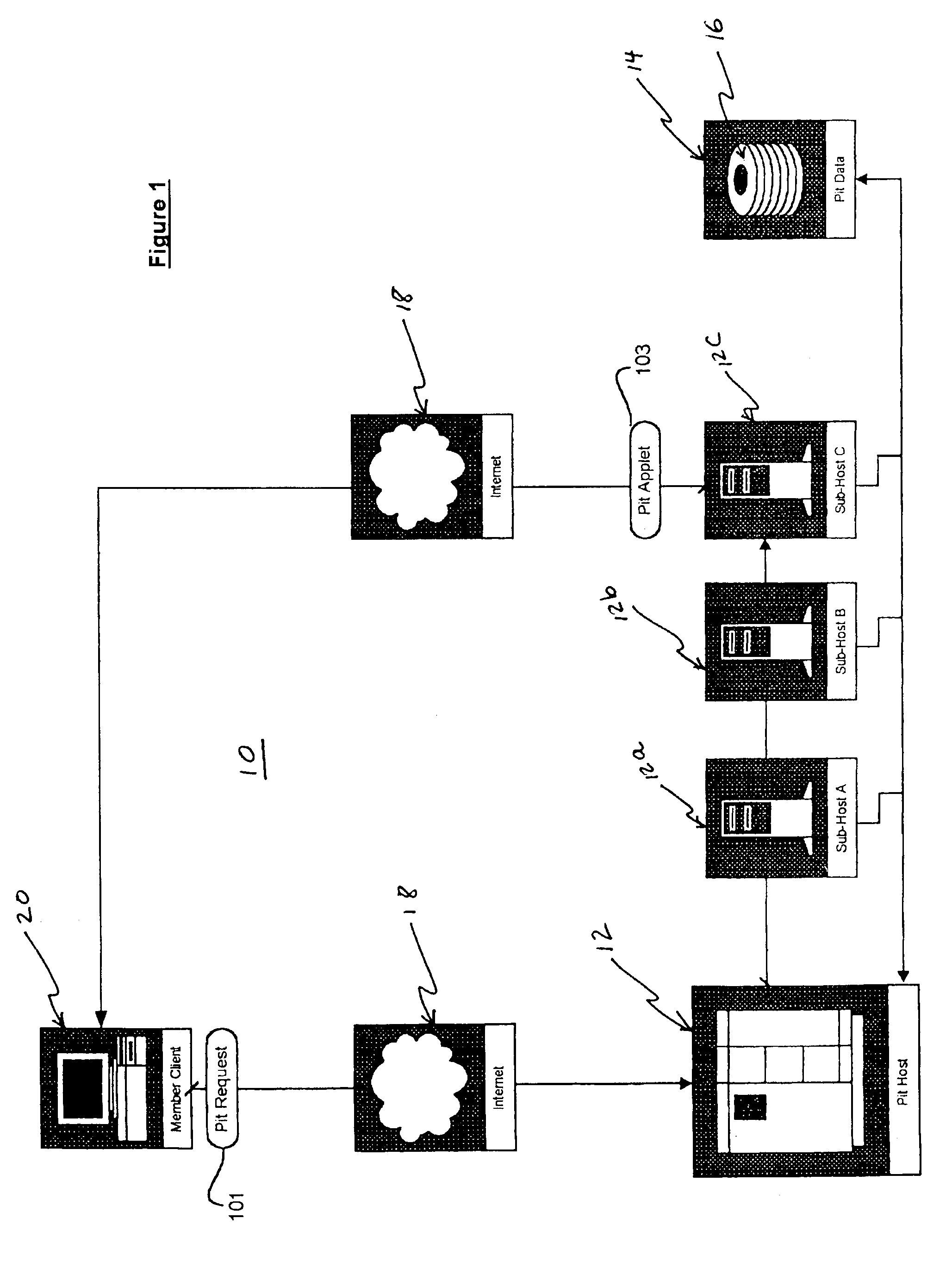

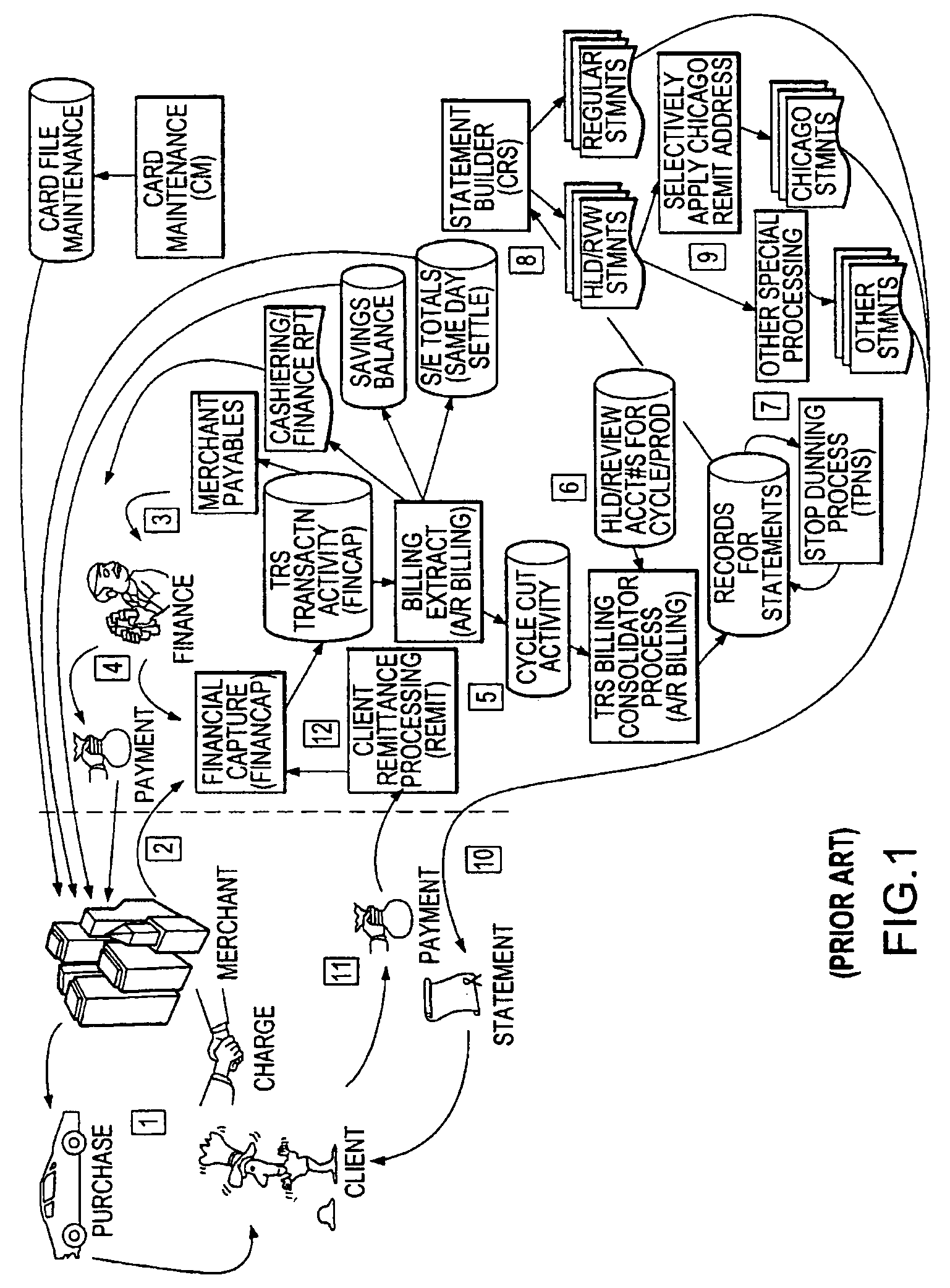

Parimutuel wagering system with opaque transactions

InactiveUS20050096124A1Apparatus for meter-controlled dispensingBuying/selling/leasing transactionsDeposit accountCredit union

A seamless ledger-based wagering system is provided wherein a secure, flexible and automated database method and apparatus is used for retrieving information and accounting for wagers in an electronic wagering format. The accounting system can be a ledger wherein funds are accounted for by a financial structure (e.g., financial institution such as a bank, credit union, savings and loan, deposit account, and the like) so that funds may be transferred through an intermediate transaction (e.g., the electronic wager entered onto the account) on the ledger and committed to payment at the ultimate target of the transfer (e.g., the pari-mutuel site, and ancillary recipients of wagering monies, such as horseman's associations, totalisator companies, automated machine lessors, track association, governmental agencies and the like). As the financial records from the financial structure never ‘sees’ the wagering facility in the transaction, transferring funds or guaranteeing funds to the intermediate transaction on a ledger, the entire transaction is in compliance with state and national regulations prohibiting or limiting or rendering illegal the availability of funds in the wagering transaction or transferring funds into a wagering account.

Owner:ASIP HLDG INC

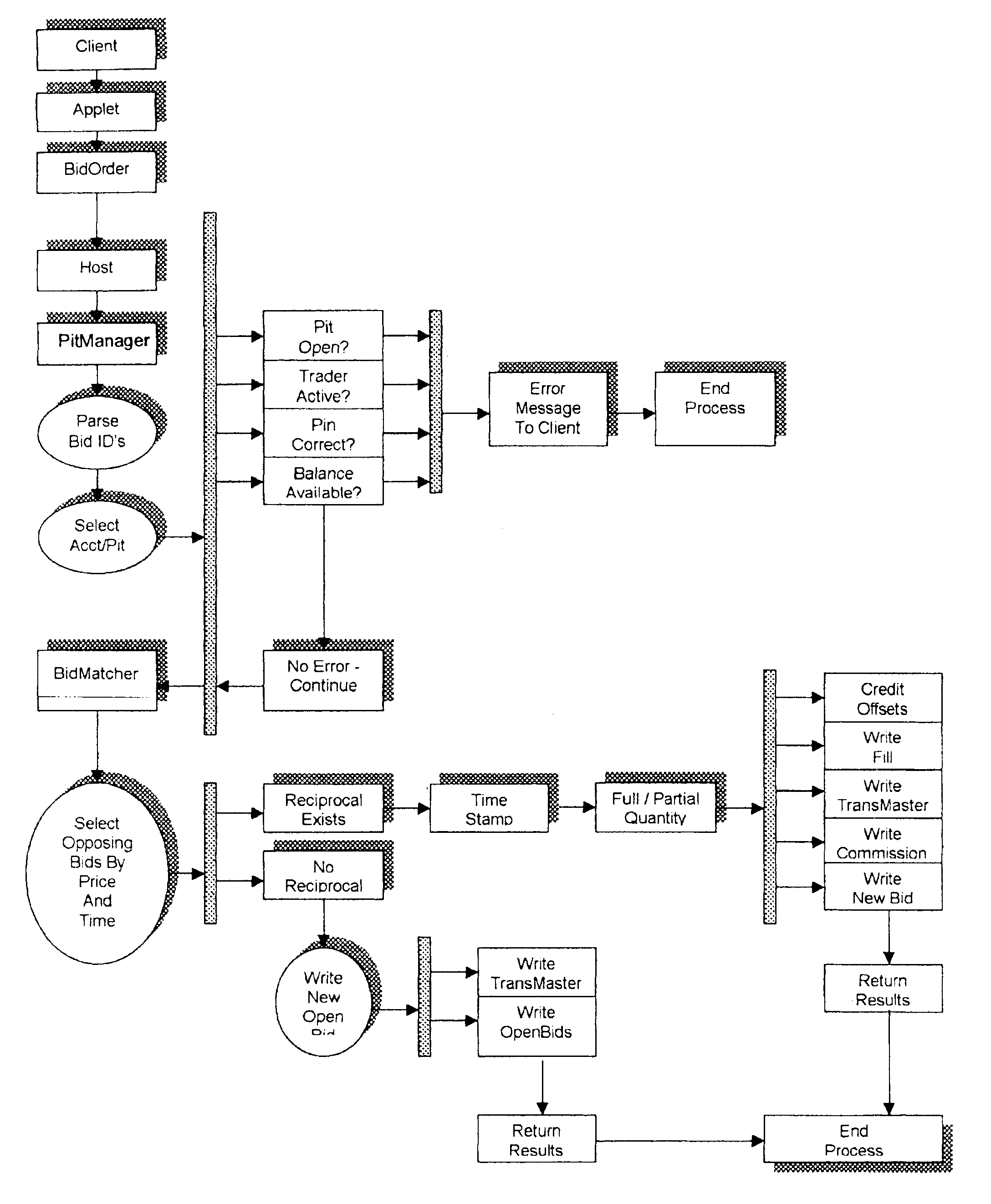

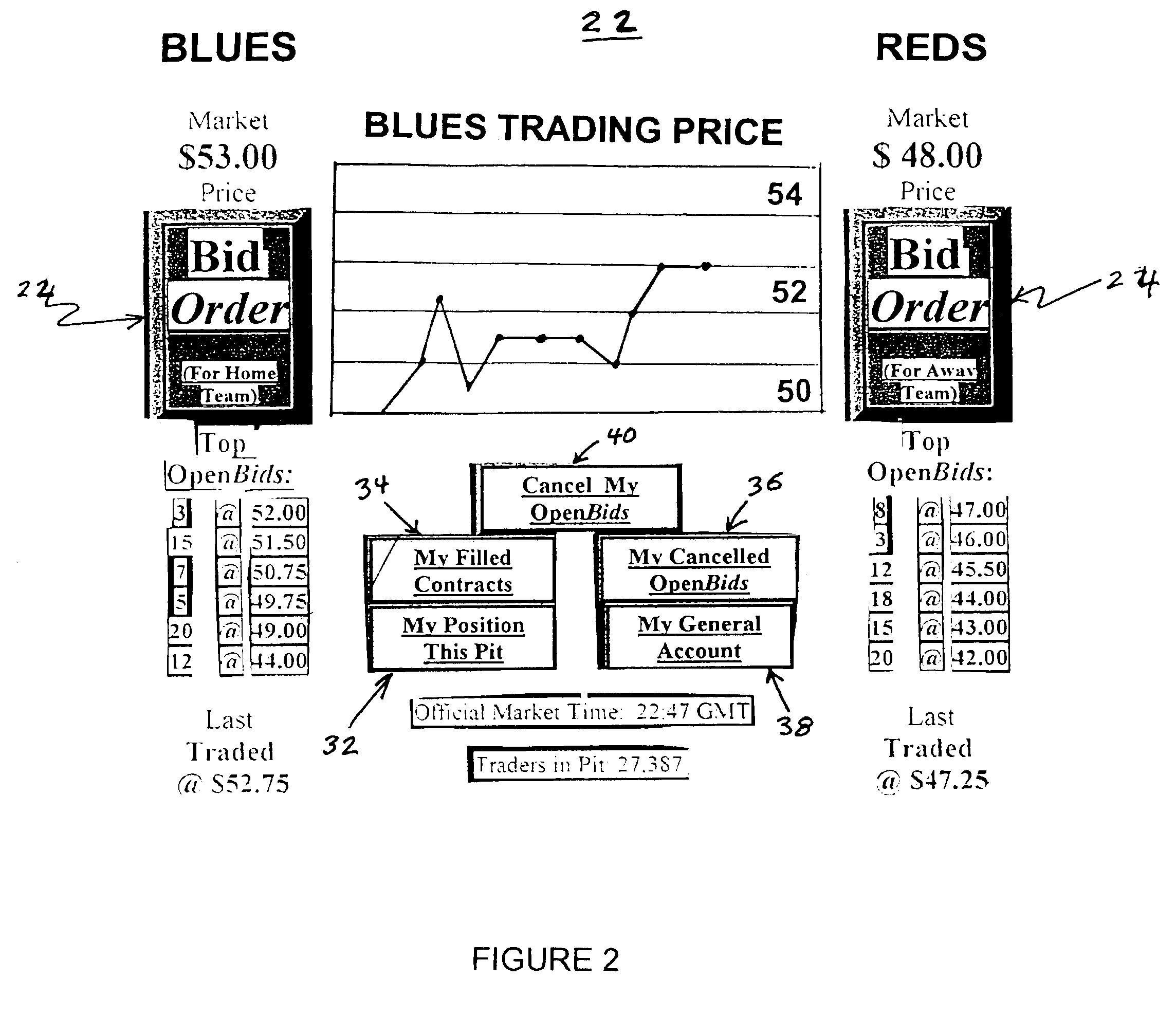

Trading system for fixed-value contracts

A trading system for the trading of fixed-value contracts employs a novel form of contract that has a fixed face value and two sides that respectively represent mutually exclusive outcomes. Traders submit bids specifying a selected “side” of the contract, a price, and a contract quantity specification, for matching with complementary bids submitted for the opposing “side” of the contract, thereupon occasioning “filled” trades. Upon the termination of the contract in accordance with pre-established criteria, resulting in the determination of a prevailing side of the contract, holders of filled contracts whose bid specified the prevailing “side” of the contract receive the face value of the contract. The trading system of the invention is preferably implemented In computerized embodiments that enable traders to submit bids to a host computer over a network, and said host computer provides traders with access to all pertinent trading information in real time, automatically matches complementary bids, and enables the immediate clearing and settlement of all filled trades from deposit accounts established by traders using the system.

Owner:CONVERGENCE WORLDWIDE

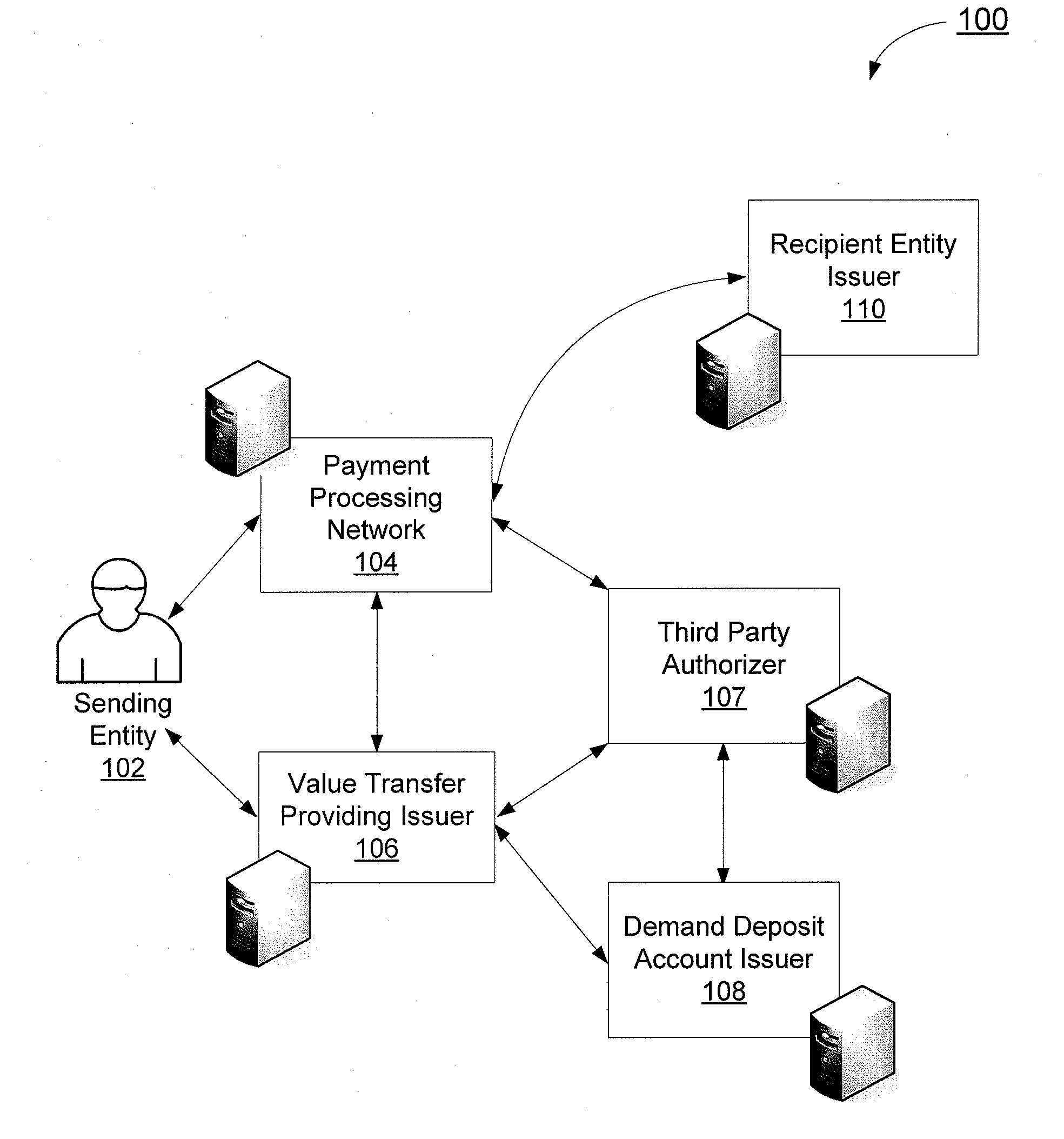

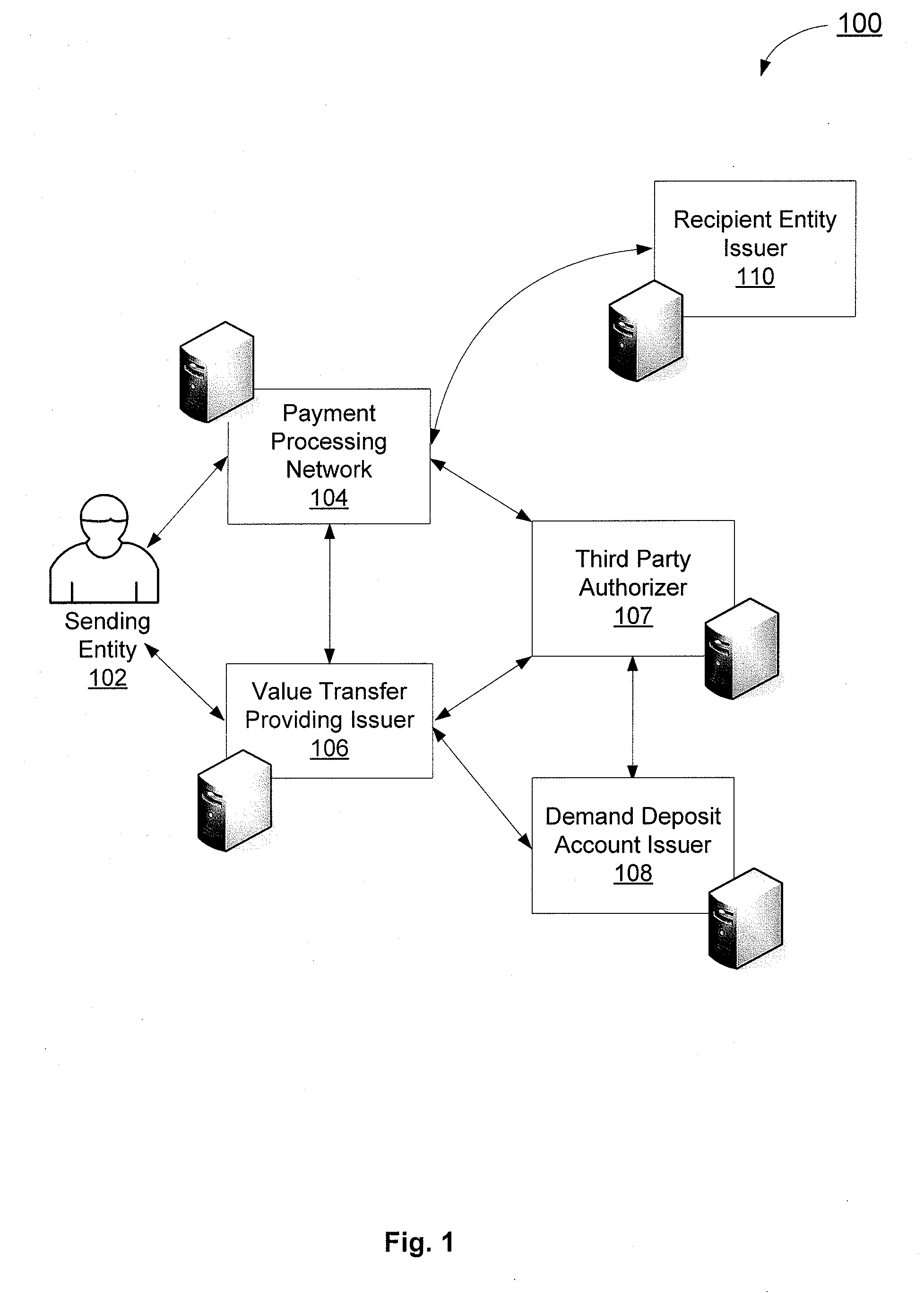

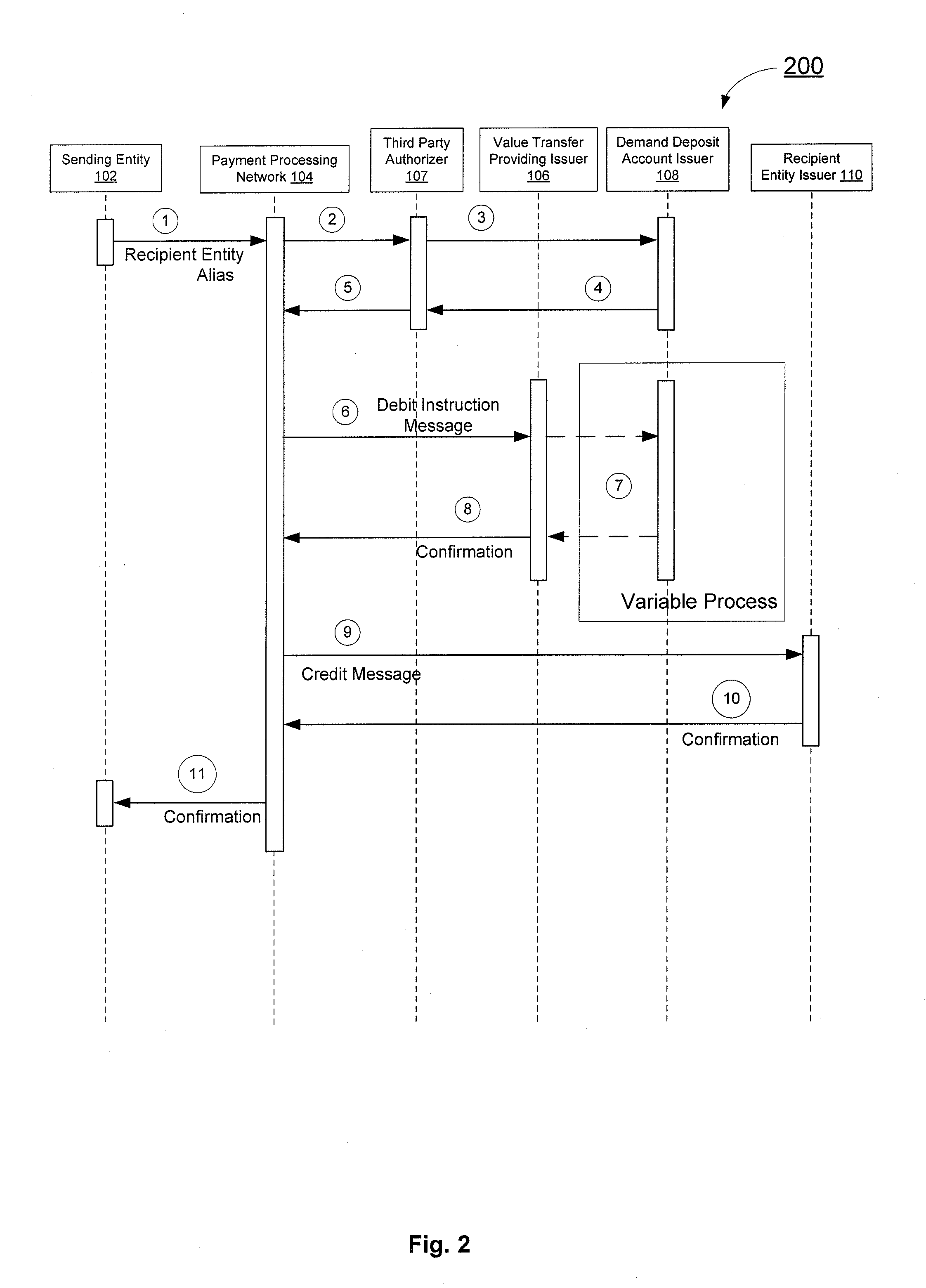

Alias management and off-us dda processing

An alias management and off-us demand deposit account processing system is disclosed. A sending entity initiates a value transfer with a payment processing network indicating a value transfer providing issuer which will conduct the value transfer and a demand deposit account issuer which hosts the demand deposit account that funds the value transfer. The sending entity is able to conduct a value transfer via a value transfer providing issuer using funds from an account with another issuer.

Owner:VISA INT SERVICE ASSOC

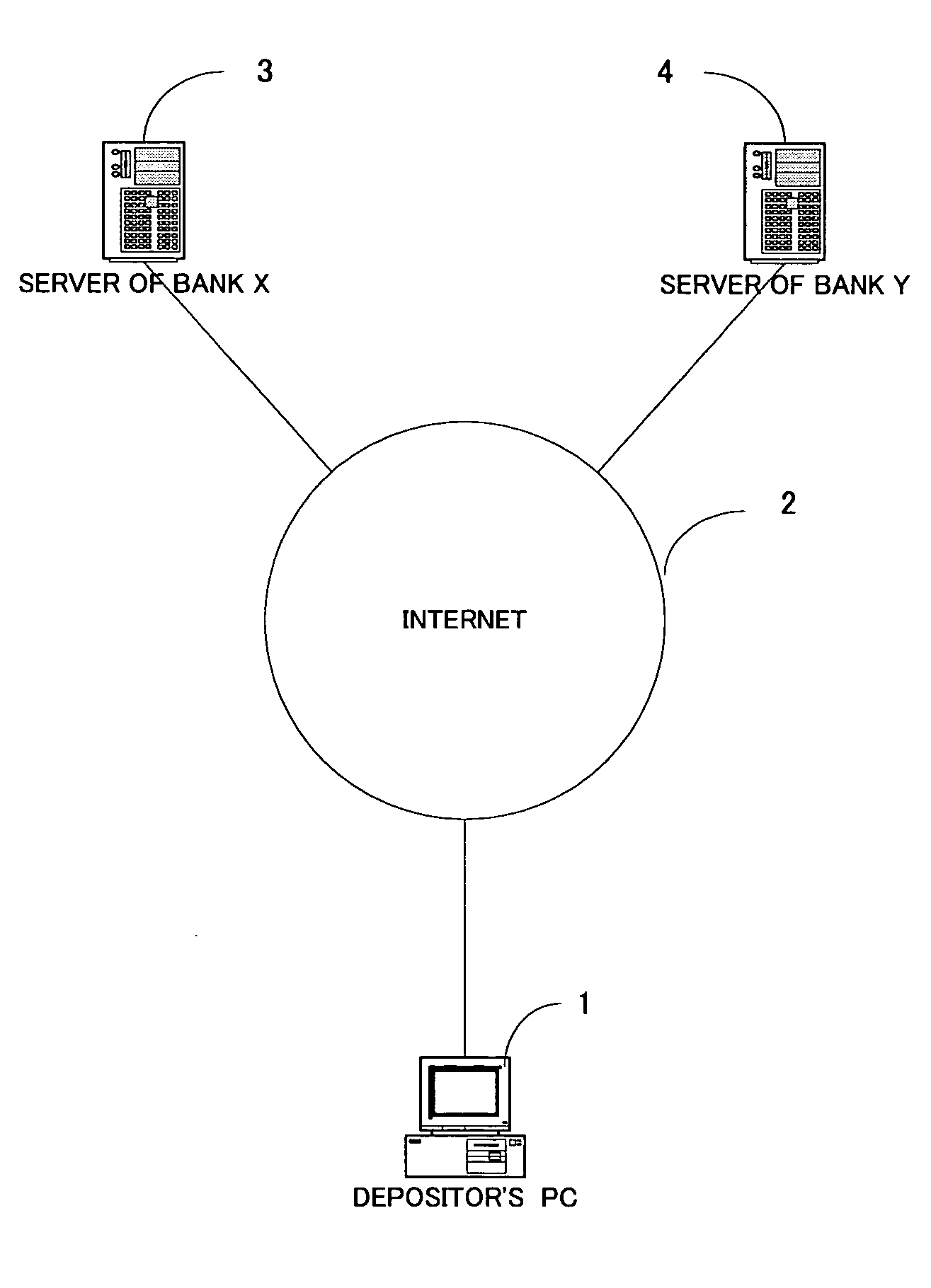

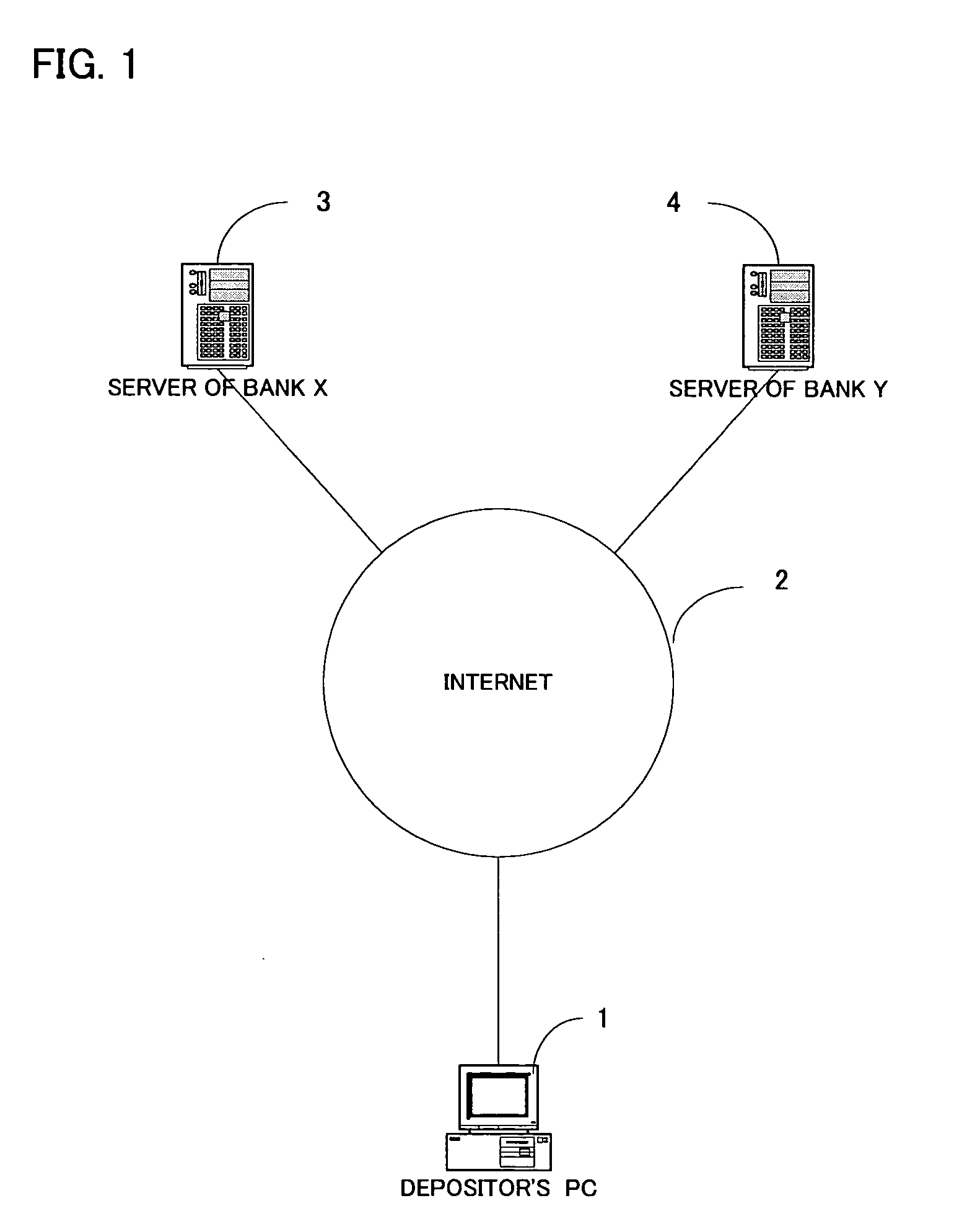

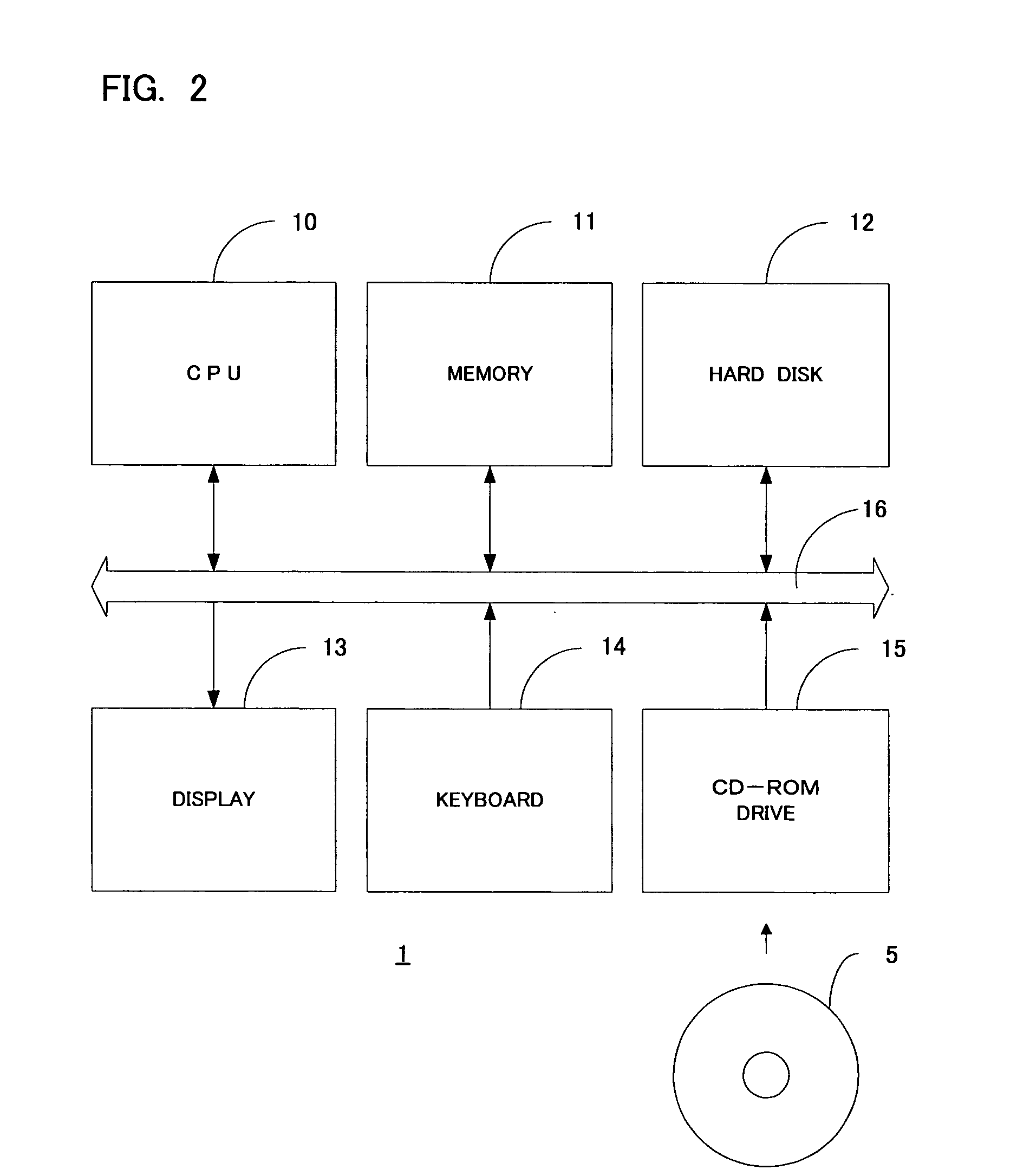

Bank account automatic adjustment system

InactiveUS20040177036A1More balancedMinimize as littleFinanceComputer security arrangementsDeposit accountBank account

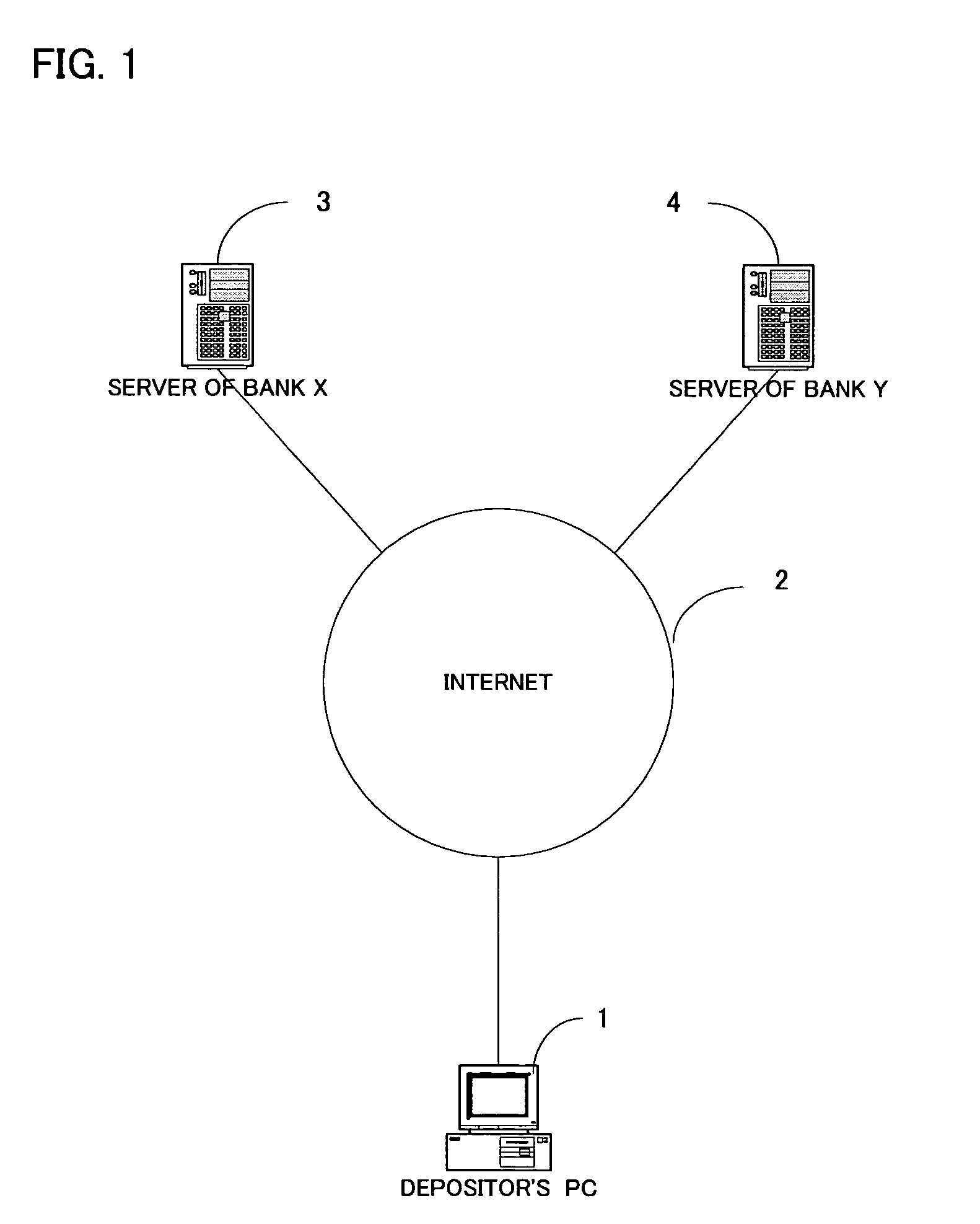

The present system for automatically adjusting deposit balance is the effective measure for pay-off which calculates the excess amount by subtracting from the balance of the account established in one financial institution, the specified balance for the account and calculates the allowable amount by subtracting from the specified balance for the account established in other financial institution, the balance of the account and compares said excess amount with said allowable amount and sets the transfer amounts as the one lesser of either said excess amount or said allowable amount. Specifically the system for automatically adjusting deposit sets in addition the plus specified balance for checking and savings accounts and time deposit account respectively when said accounts include checking account and savings account and time deposit accounts. The system for automatically adjusting deposit further sets the minus specified balance for the debt amount. Preferably the system for automatically adjusting deposit is an apparatus which enables to maintain the necessary balance and calculates the deficit amount by subtracting from the balance for the account established in one financial institution, the necessary balance for the account and calculates the surplus amount by subtracting from the necessary balance for the account established in said other financial institution, the balance for the account and compares said deficit amount with the surplus amount and sets the amount that is lesser of said deficit or surplus amounts for the transfer amount.

Owner:NUTAHARA ATSUO +1

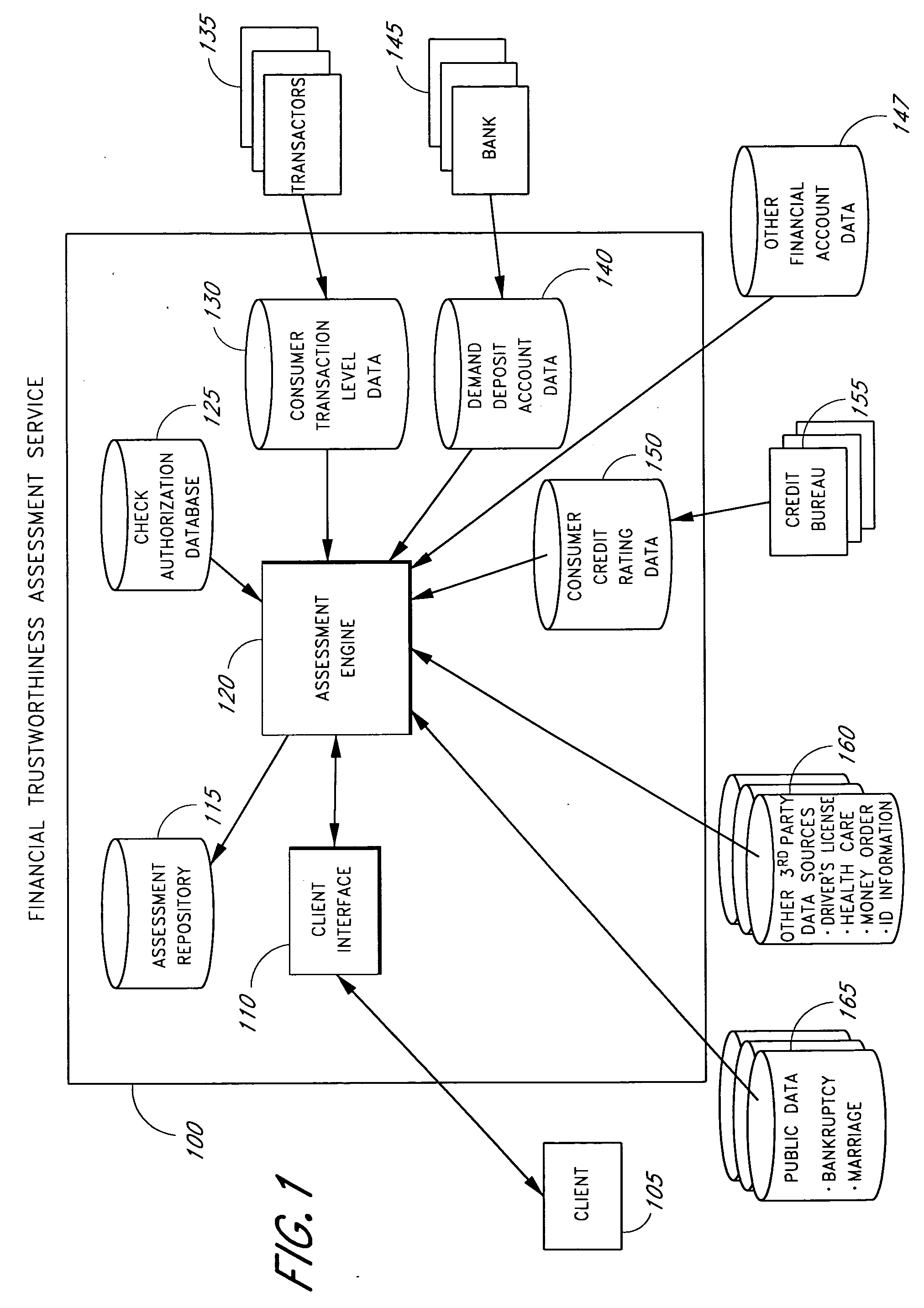

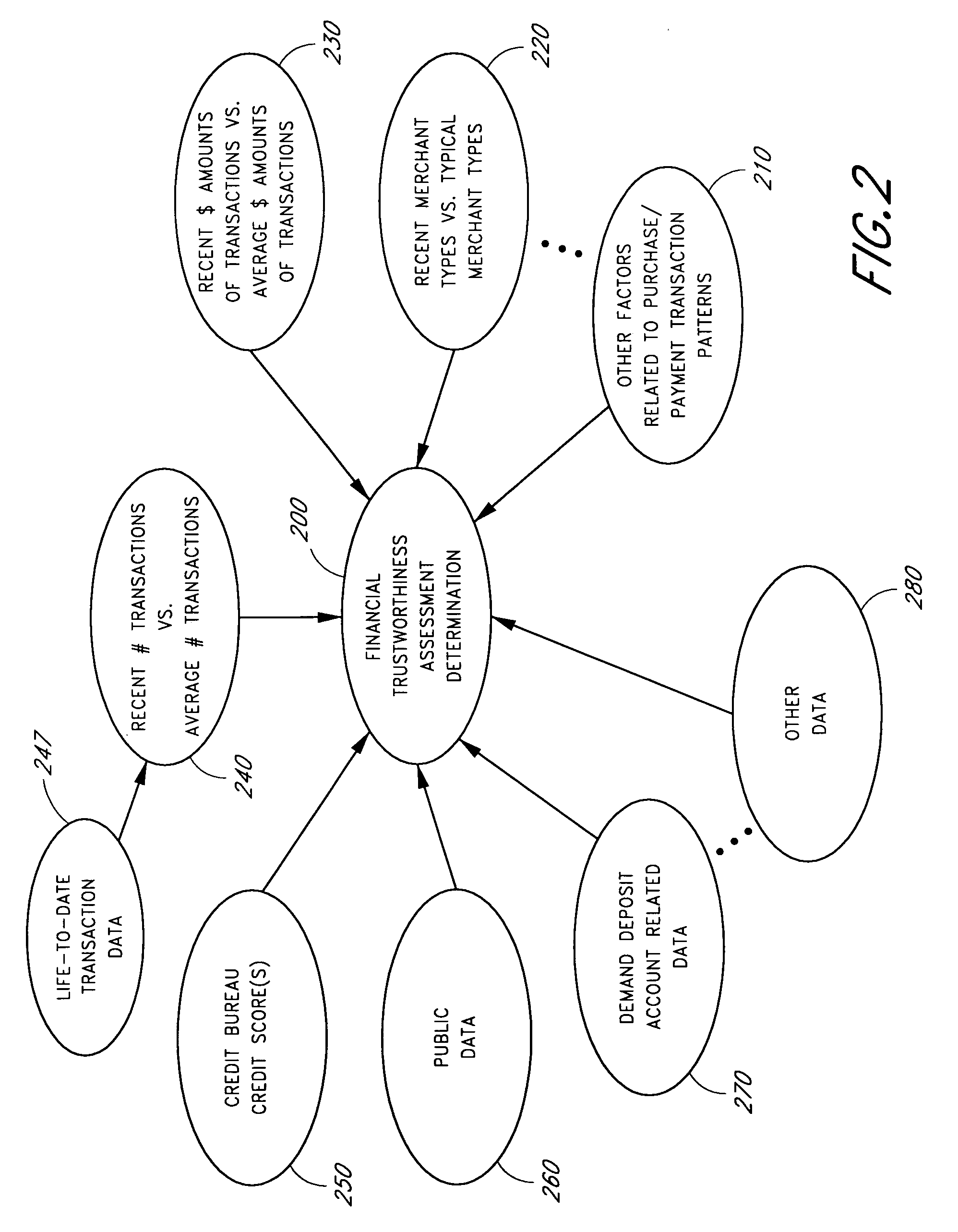

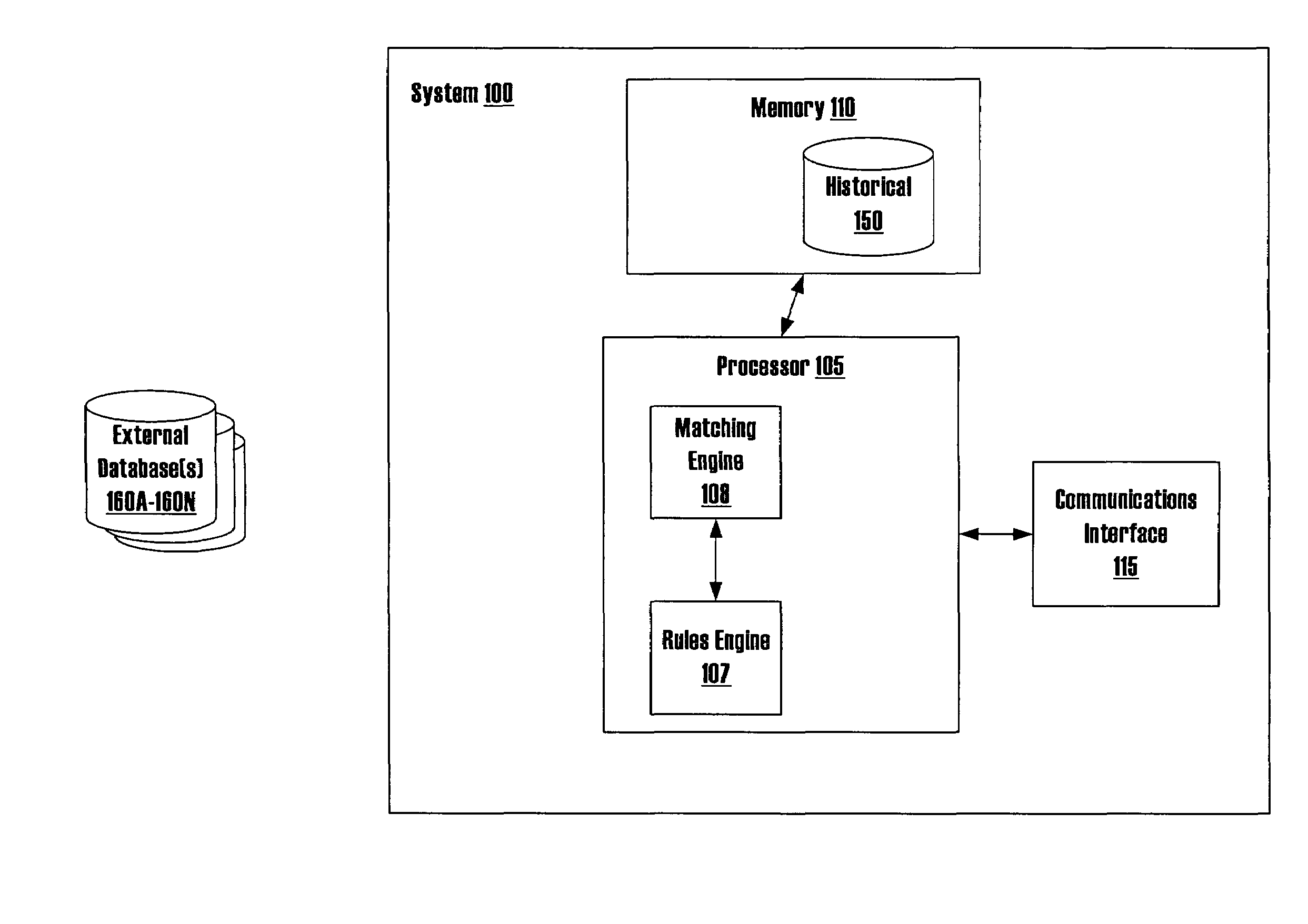

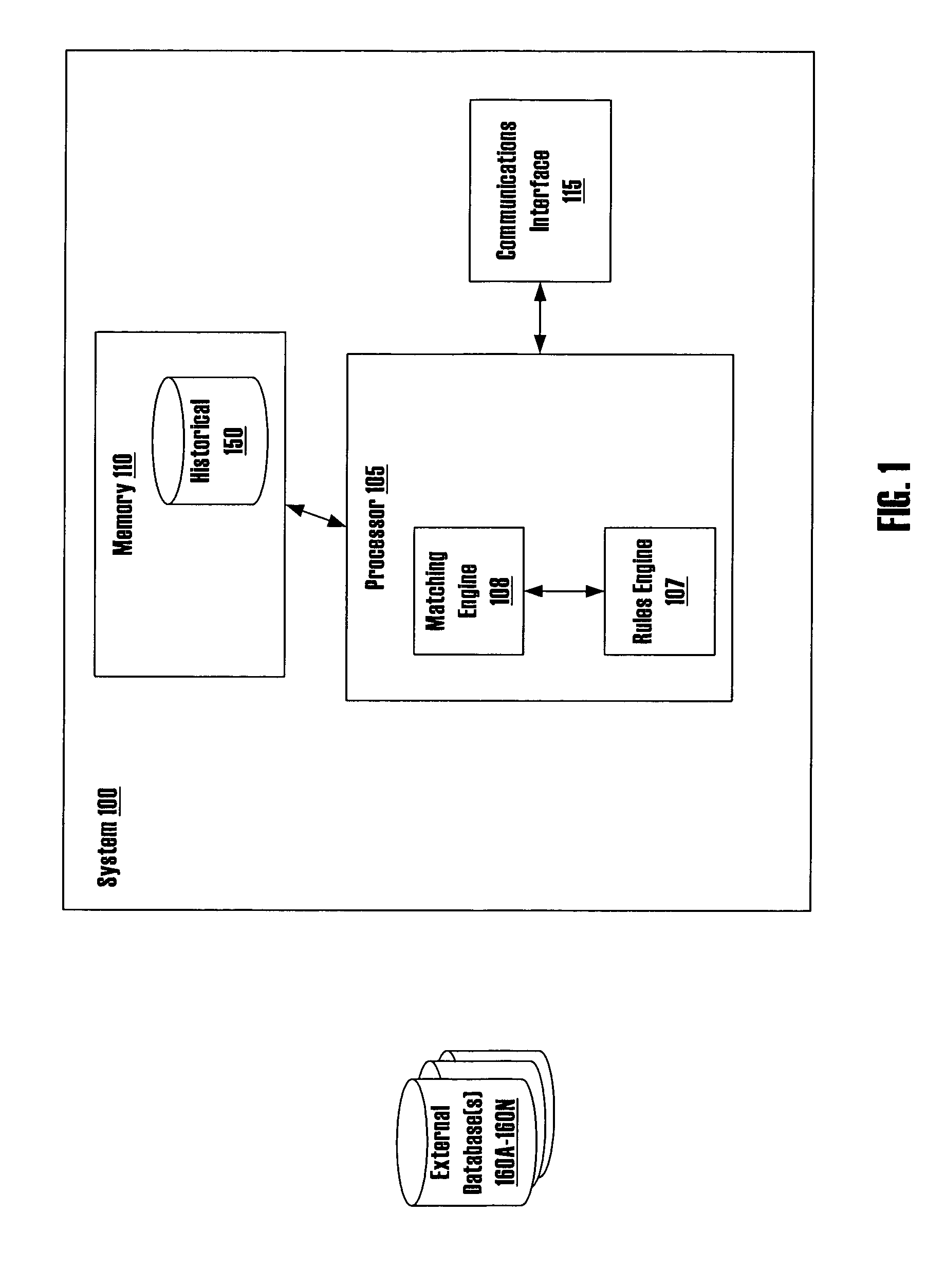

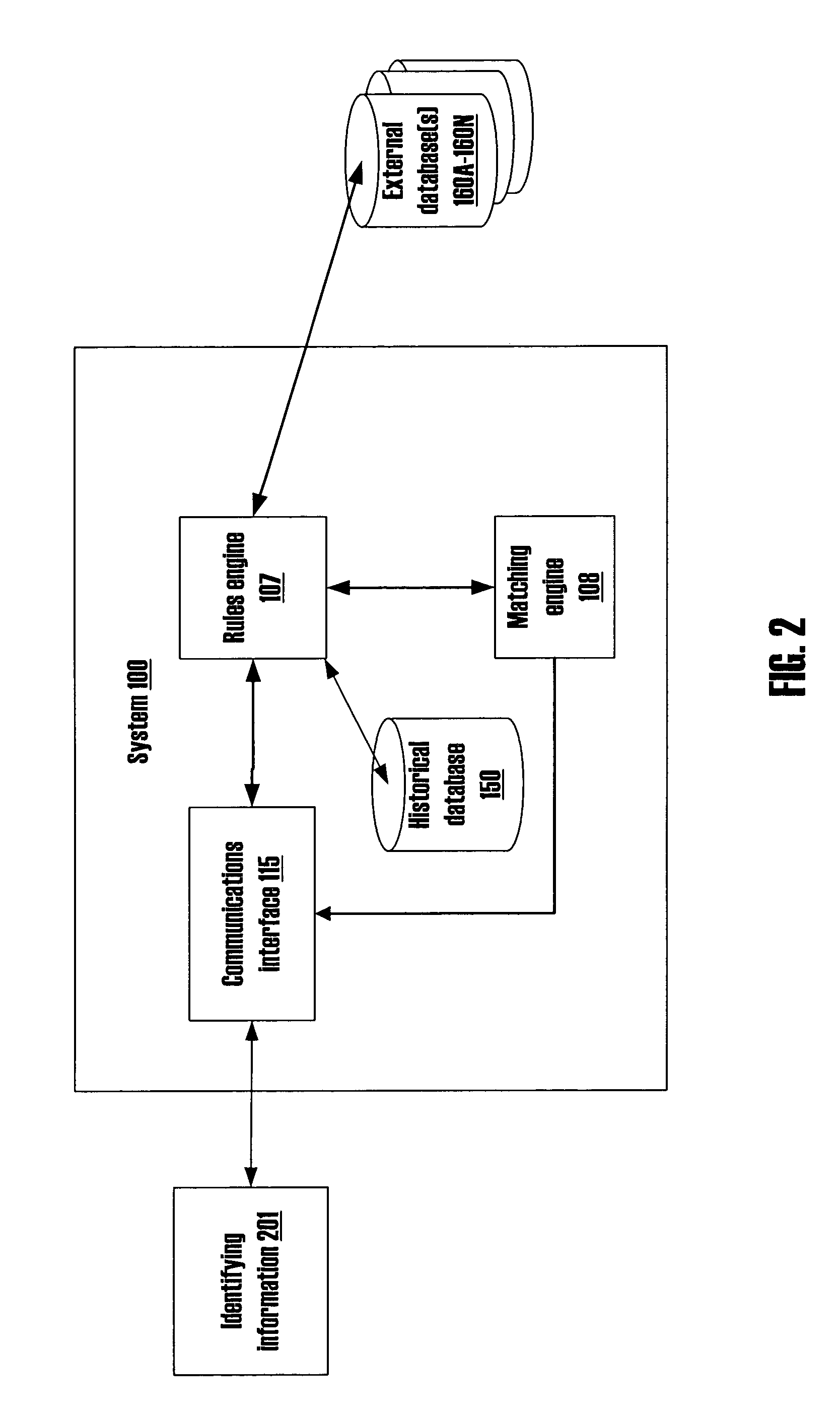

Systems and methods for performing a financial trustworthiness assessment

InactiveUS20080059364A1Accurately reflectQuick identificationFinancePayment architectureThird partyDeposit account

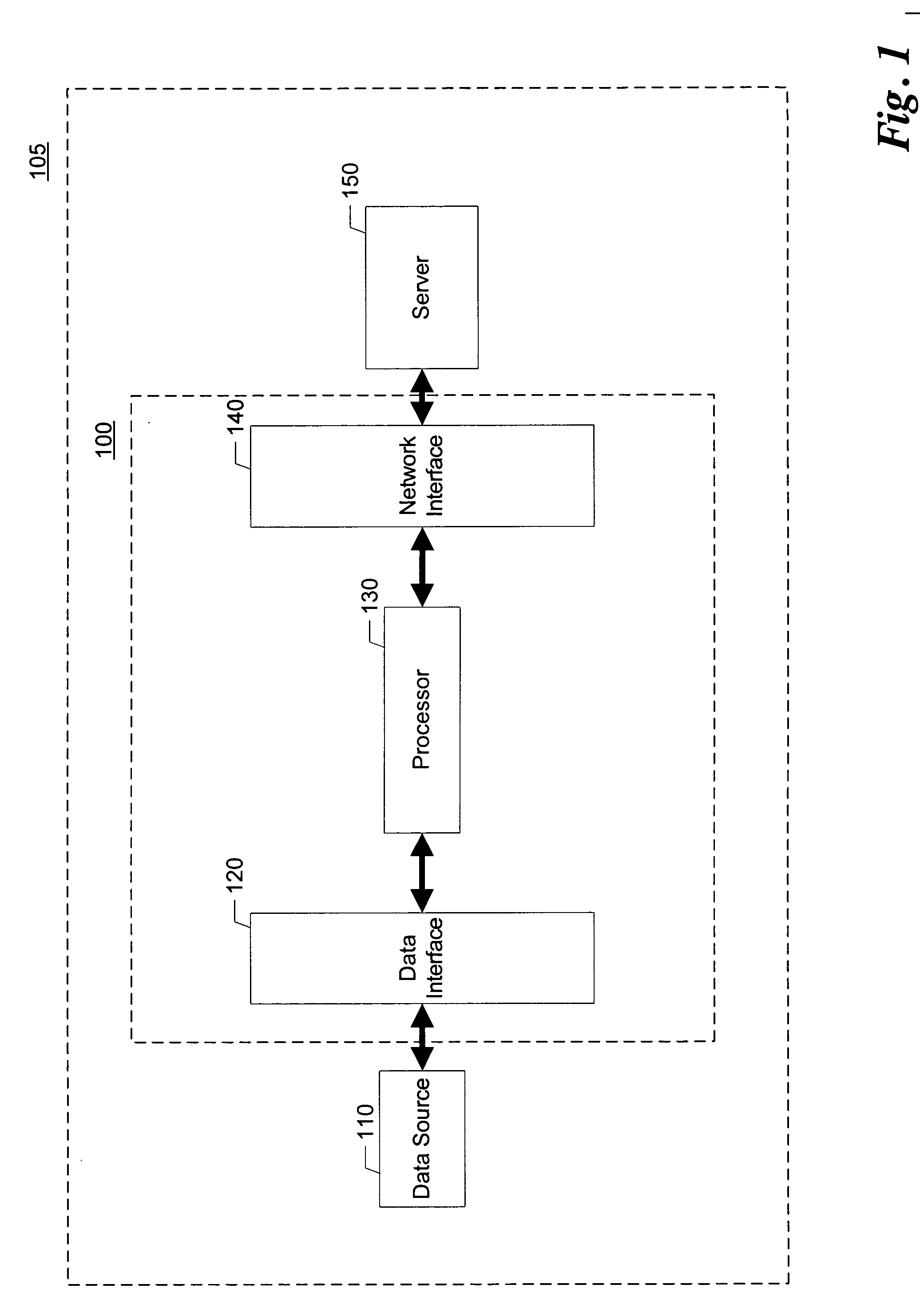

Systems and methods are described in connection with a financial trustworthiness assessment service that provides an assessment of an individual's financial trustworthiness that is not necessarily on credit bureau information. The financial trustworthiness assessment is based, at least in part, on transaction-level financial information associated with the individual, as well as on other data associated with the individual that may be financially-based or otherwise indicative, alone or in conjunction with other data, of financial trustworthiness. For example, the assessment may be based at least in part on information from one or more repositories of information, including, but not limited to a check authorization database, a demand deposit account database, a consumer credit rating database, public data (such as bankruptcy and marriage records), department of motor vehicle records, and other third party data sources.

Owner:FIRST DATA

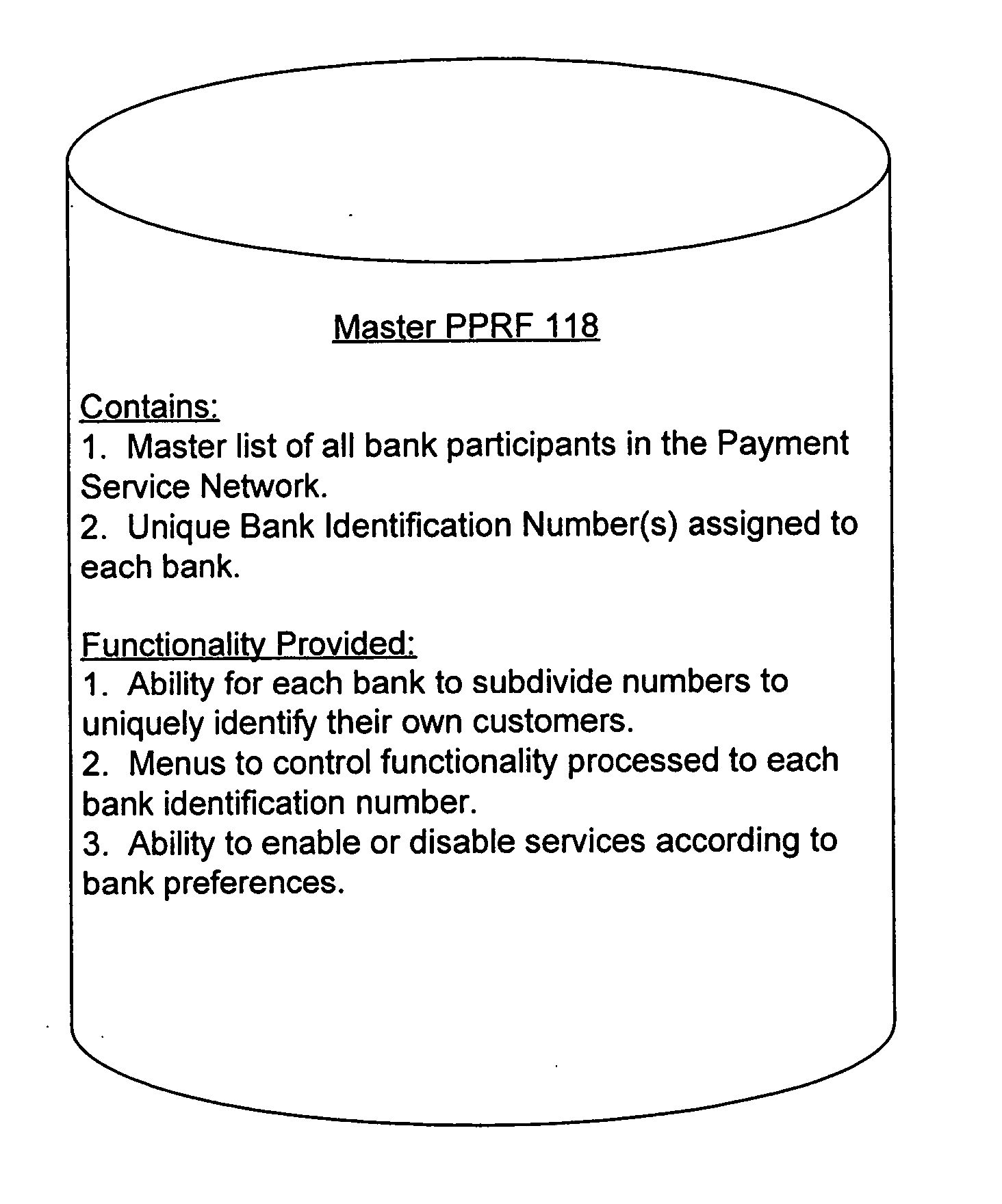

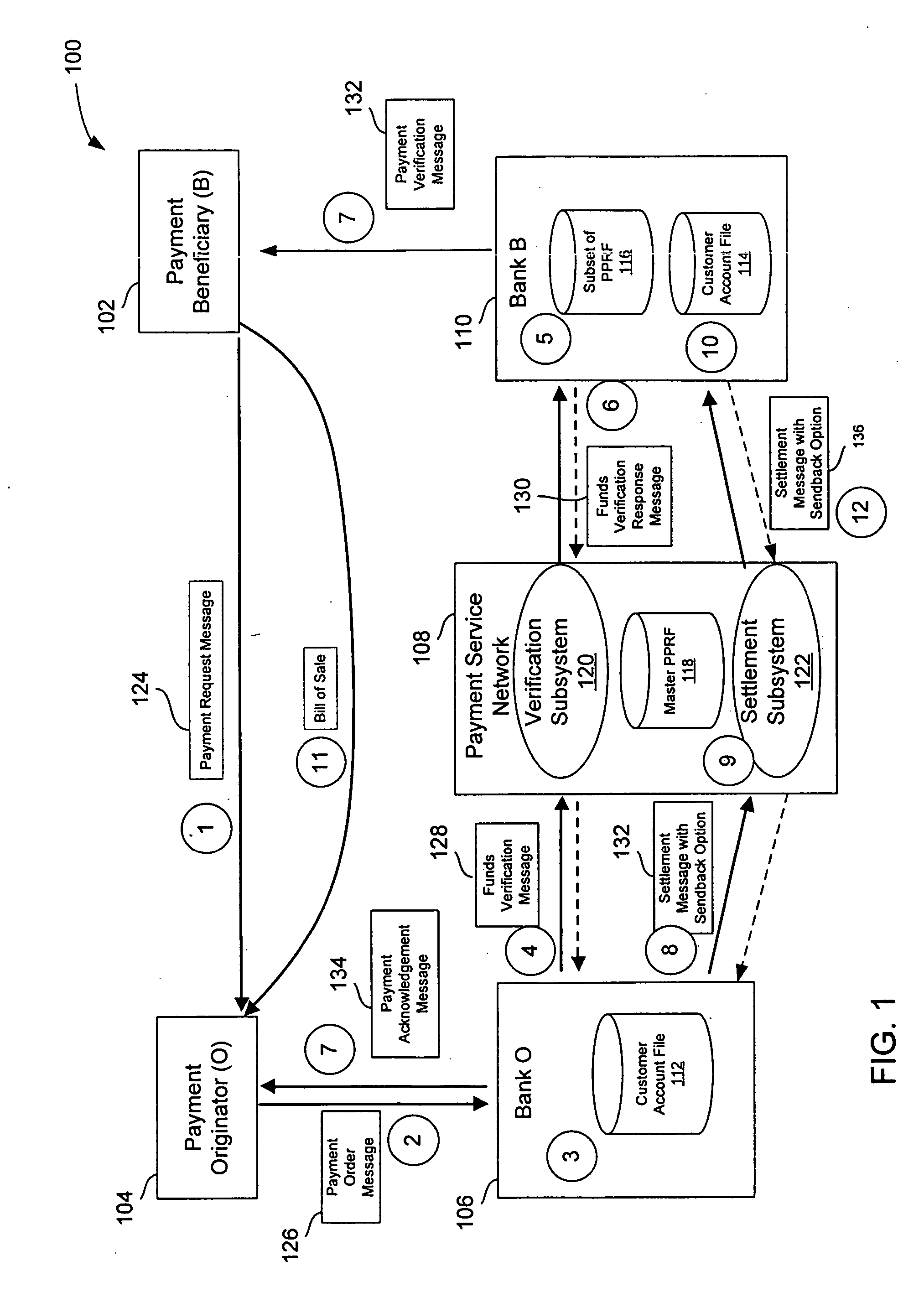

Buyer initiated payment

Transferring funds from a payment originator (or payor) to a payment beneficiary (or payee) pushes the funds directly to a beneficiary's bank. The beneficiary's bank is not required to actively pull funds into the beneficiary's account. An originator can use a publicly known beneficiary indicator to direct payment to the beneficiary. The publicly known beneficiary indicator can be publicly used without exposing a beneficiary account to unauthorized debits or fraud since it can only be used to make credits to the beneficiary account, e.g. a deposit-only account. A pre-settlement conversation is used between the two banks to verify and evaluate information about an upcoming transfer of funds to determine whether to accept the funds transfer. The messages in the pre-settlement conversation contain information about the transaction.

Owner:VISA INT SERVICE ASSOC

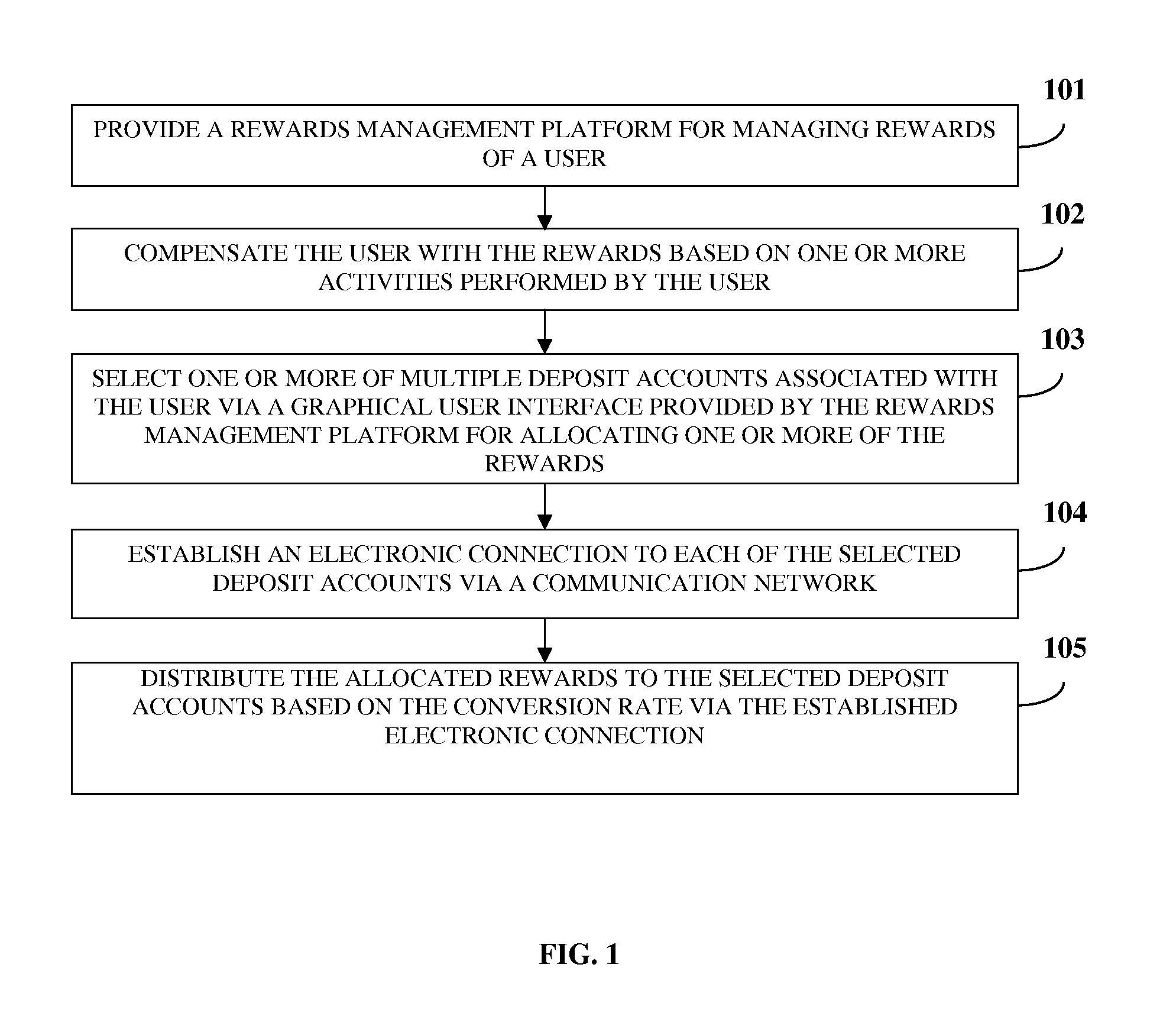

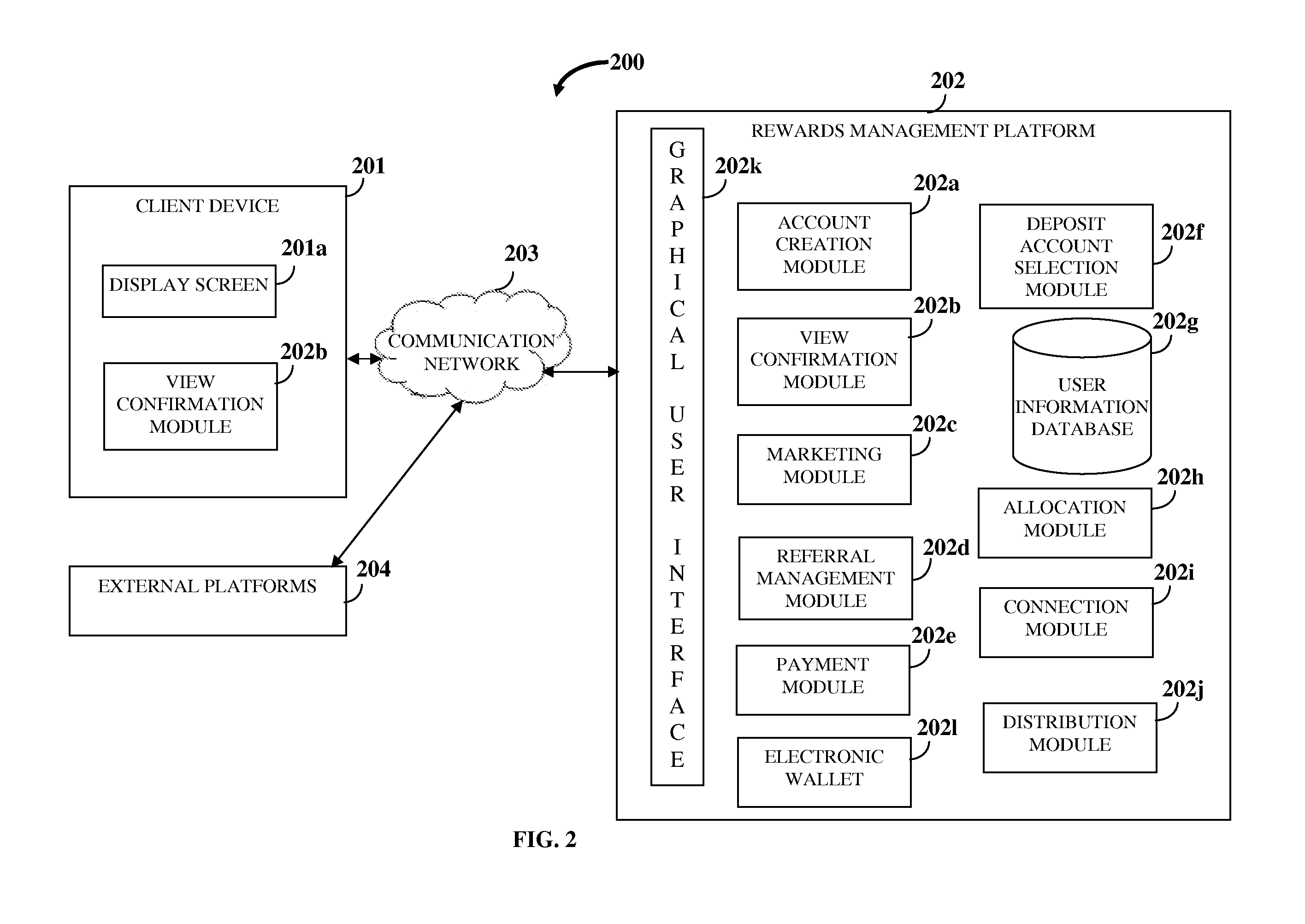

Selective Distribution Of Rewards

A computer implemented method and system for selectively distributing rewards to a user is provided. A rewards management platform is provided for managing the rewards of the user. The rewards management platform compensates the user with the rewards based on one or more activities, for example, confirming viewing of multimedia content, referring the multimedia content to other users, etc., performed by the user on the rewards management platform. The user selects one or more of multiple deposit accounts associated with the user via a graphical user interface for allocating one or more of the rewards. Each of the deposit accounts is associated with a conversion rate. The rewards management platform establishes an electronic connection to each of the selected deposit accounts via a communication network. The rewards management platform distributes the allocated rewards to the selected deposit accounts based on the conversion rate via the established electronic connection.

Owner:ADGENESIS HLDG LLC

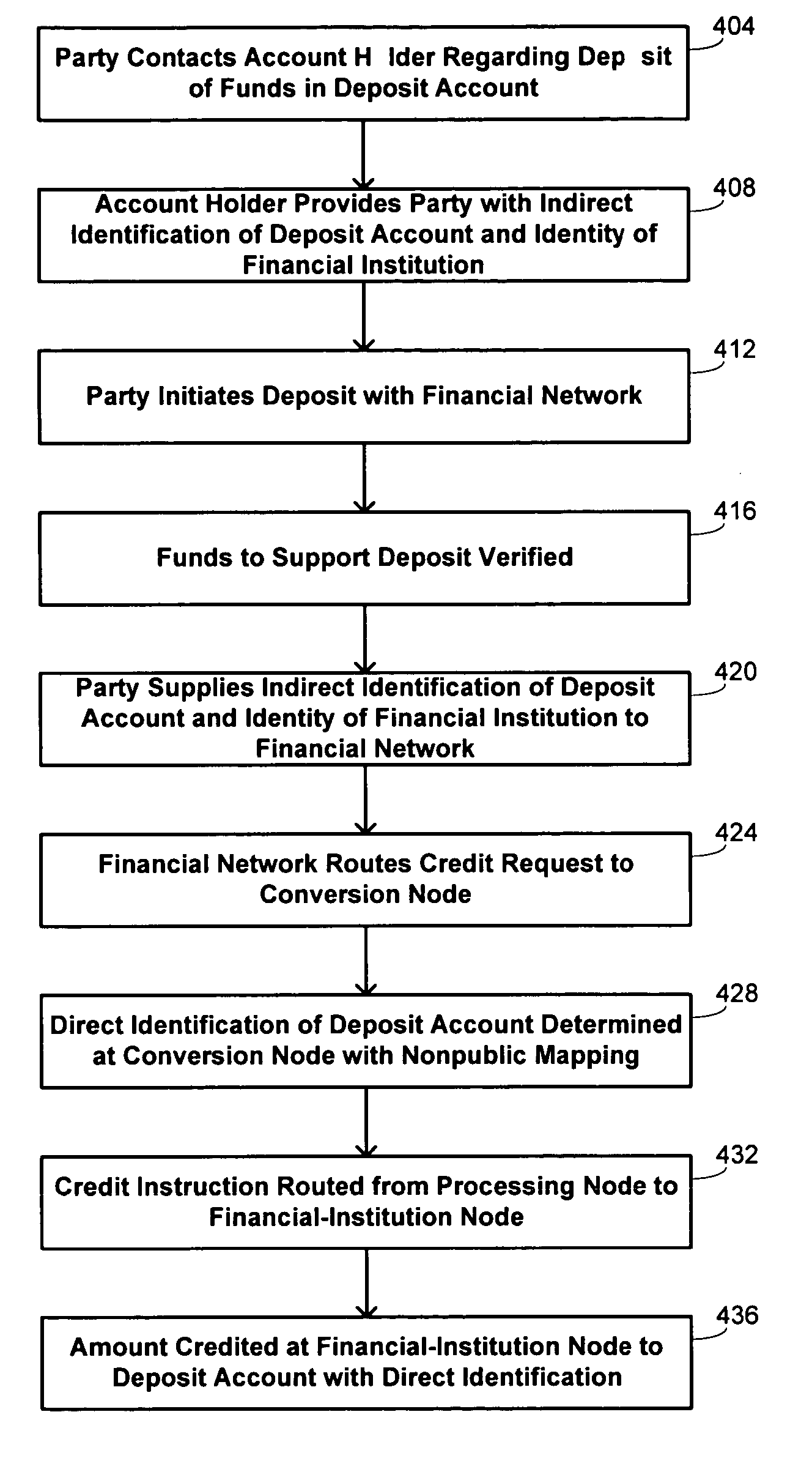

Methods and systems for transferring funds to direct-deposit accounts

Methods and systems are provided for depositing funds in a deposit account. A request to credit a specified amount to the deposit account is received at a node of a financial-services network that has multiple interconnected nodes. The request includes an indirect identification of the deposit account. A direct identification of the deposit account is determined from the indirect identification and from a nonpublic mapping of a indirect identifications to identifications of respective deposit accounts. An instruction is issued to credit the deposit account with the specified amount in accordance with the determined direct identification.

Owner:FIRST DATA

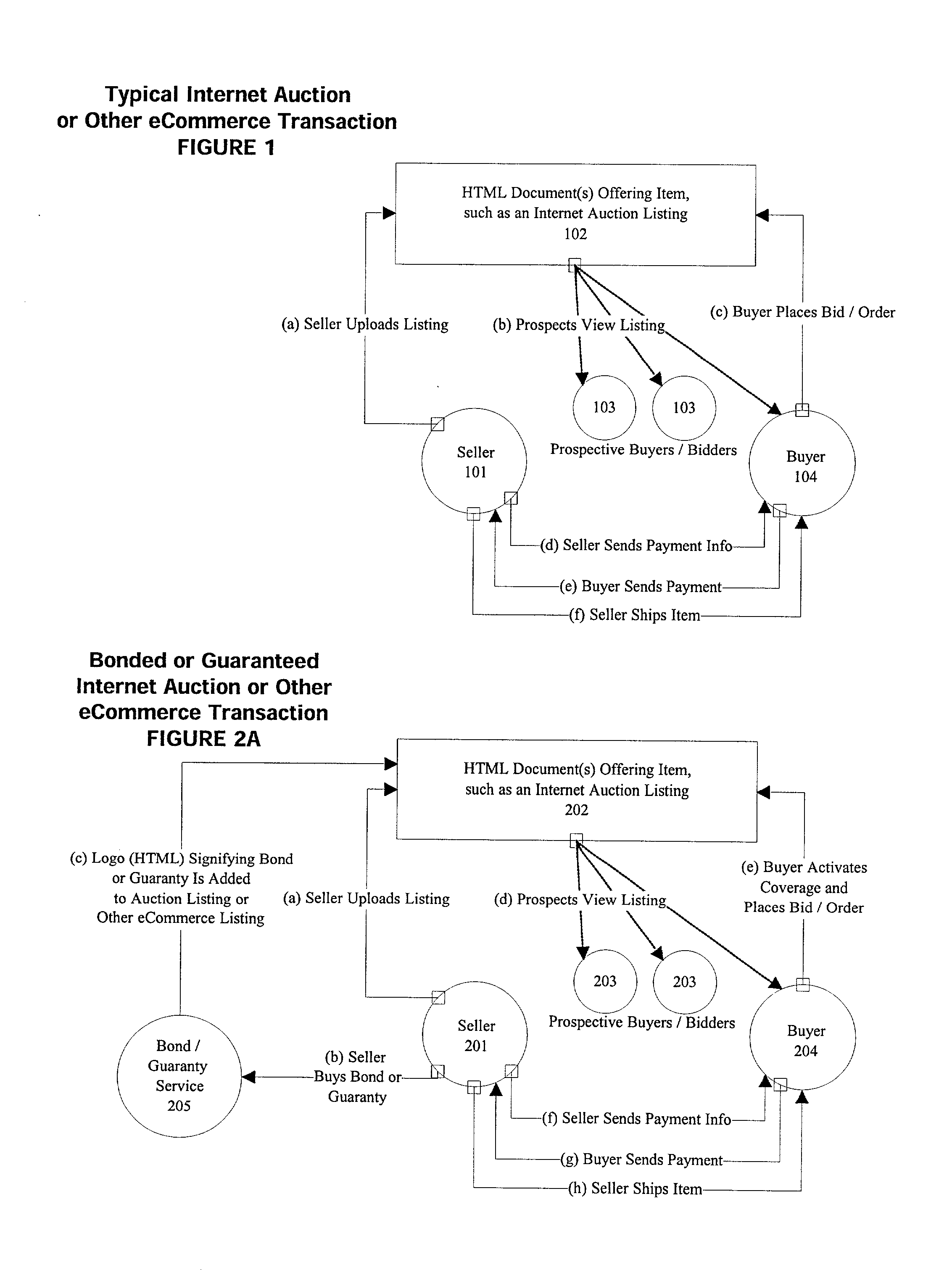

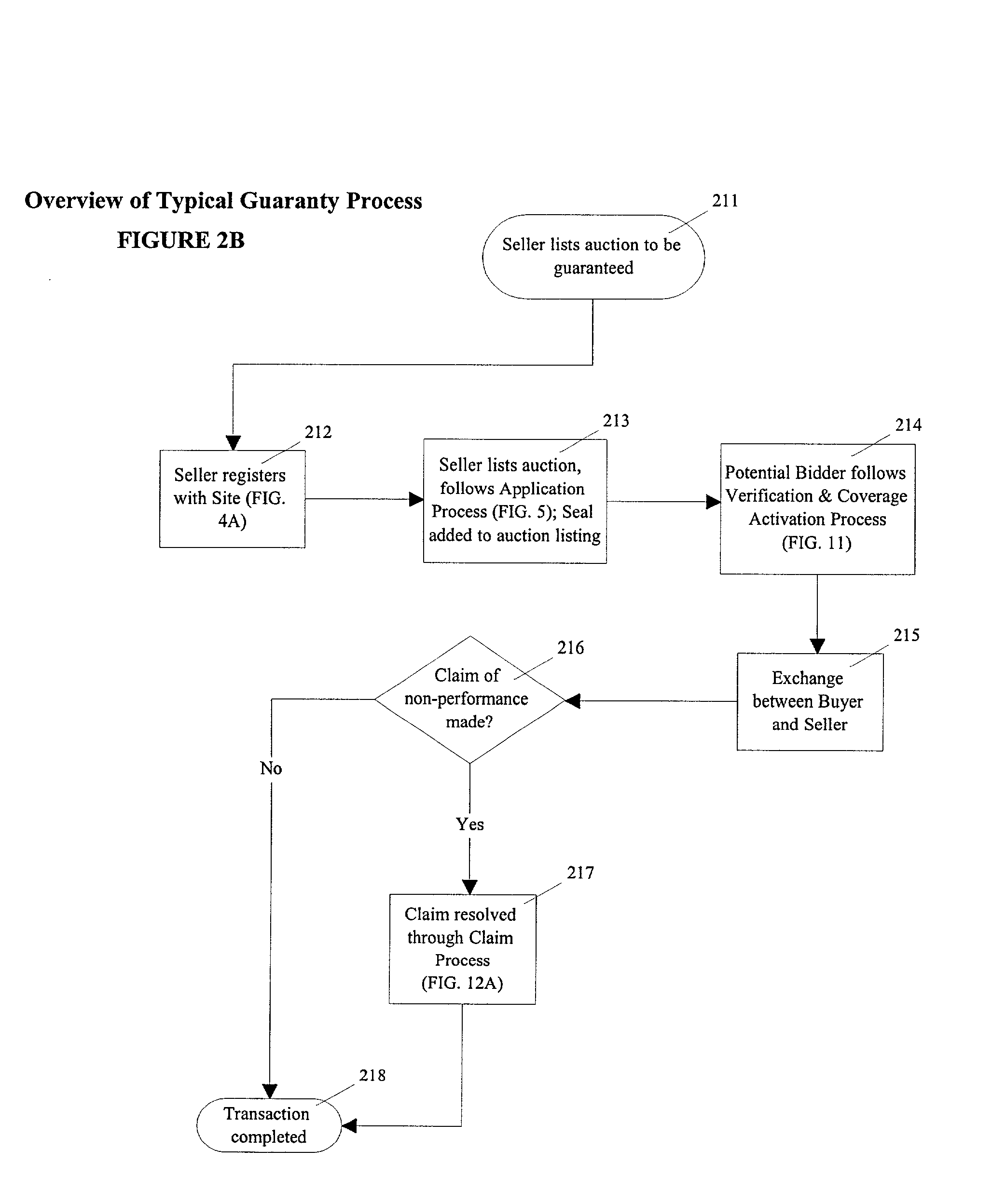

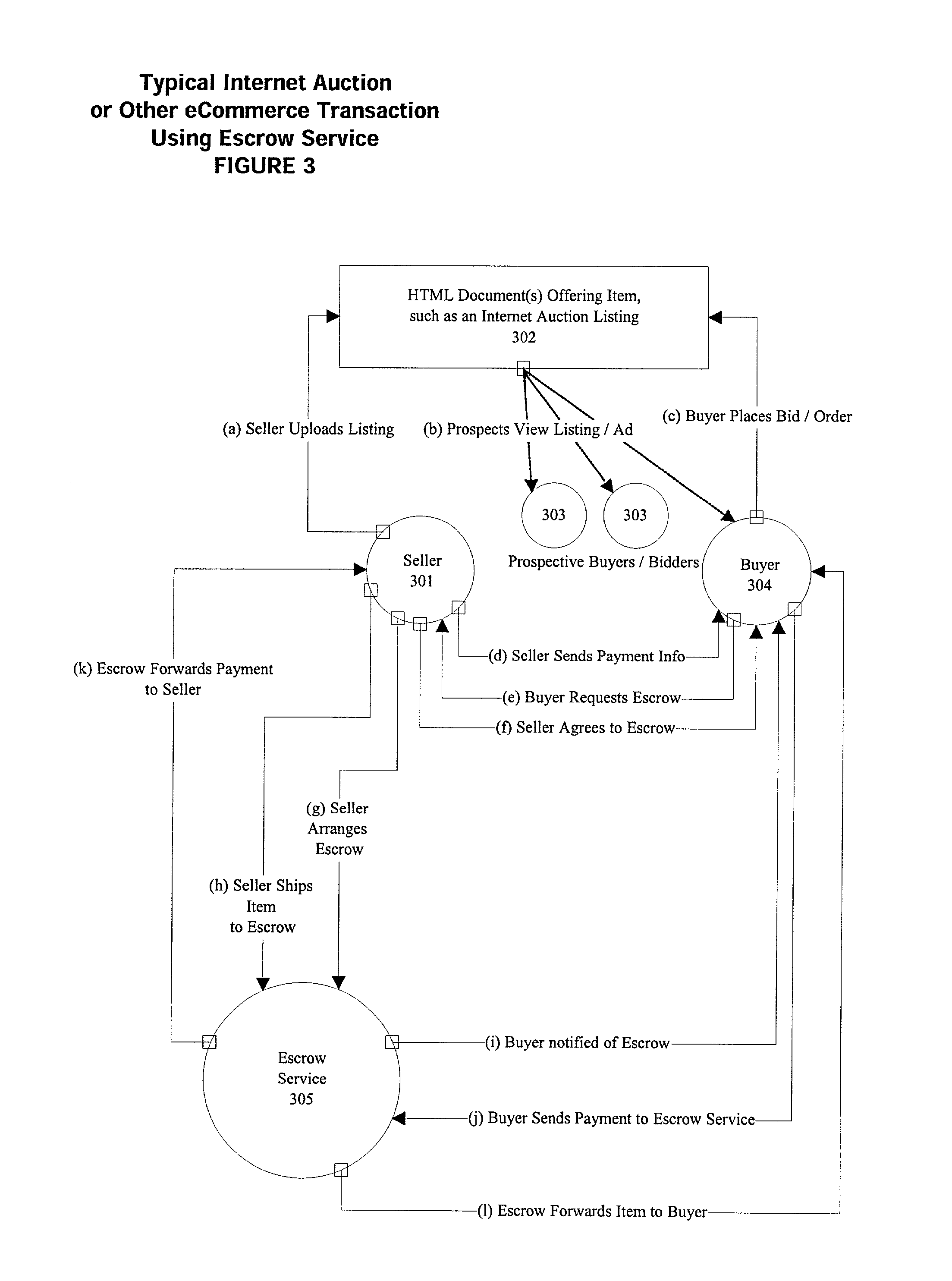

Electronic bond & guaranty process and business method

Disclosed is a method by which suretyship bonds and guaranties can be purchased and deployed over the Internet in real time, providing automatic application evaluation and policy binding. The principal's credit card information is used in a repeating cycle of pre-authorized charges so that the card account serves as effective collateral. A bond seal image, safeguarded against piracy, appears in Web pages indicating the existence of bond coverage. A dynamically updated gauge displays the margin of coverage available under the bond at any given moment. Means of integrating the information technology of auction site and surety company are also disclosed. The invention makes possible an unprecedented level of security in user-to-user auction environments and eliminates the need for online escrow services. Means of accepting bidder deposit accounts is also disclosed, enabling automatic, electronic payment the moment an Internet auction closes and eliminating the need for online payment services.

Owner:HARRISON JR SHELTON E

ATM systems and methods for cashing checks

Various techniques are provided for dispensing cash from automated teller or similar cash dispensing machines where such machines do not contain or are otherwise unable to dispense coins or certain bill denominations. Such features may be offered in combination with a request to cash a negotiable instrument, such as a check, where some or all of the amount is to be received in cash or deposited into an account. In one particular method, an automated teller machine (ATM) includes a display screen, a data entry device, a receipt printer, a bill dispenser and a reader. According to the method, information is read from a negotiable instrument using the reader. A face amount of the negotiable instrument is received at the ATM from the data entry device. The display screen is employed to display a dispense amount in bills that the ATM is capable of dispensing along with a deposit account where the remaining funds may be deposited. The user may then enter a confirmation using the data entry device to dispense the bills and to deposit the remaining funds in the deposit account. The bill dispenser may dispense the bills, and an approval may be sent to deposit the funds into the deposit account.

Owner:THE WESTERN UNION CO +1

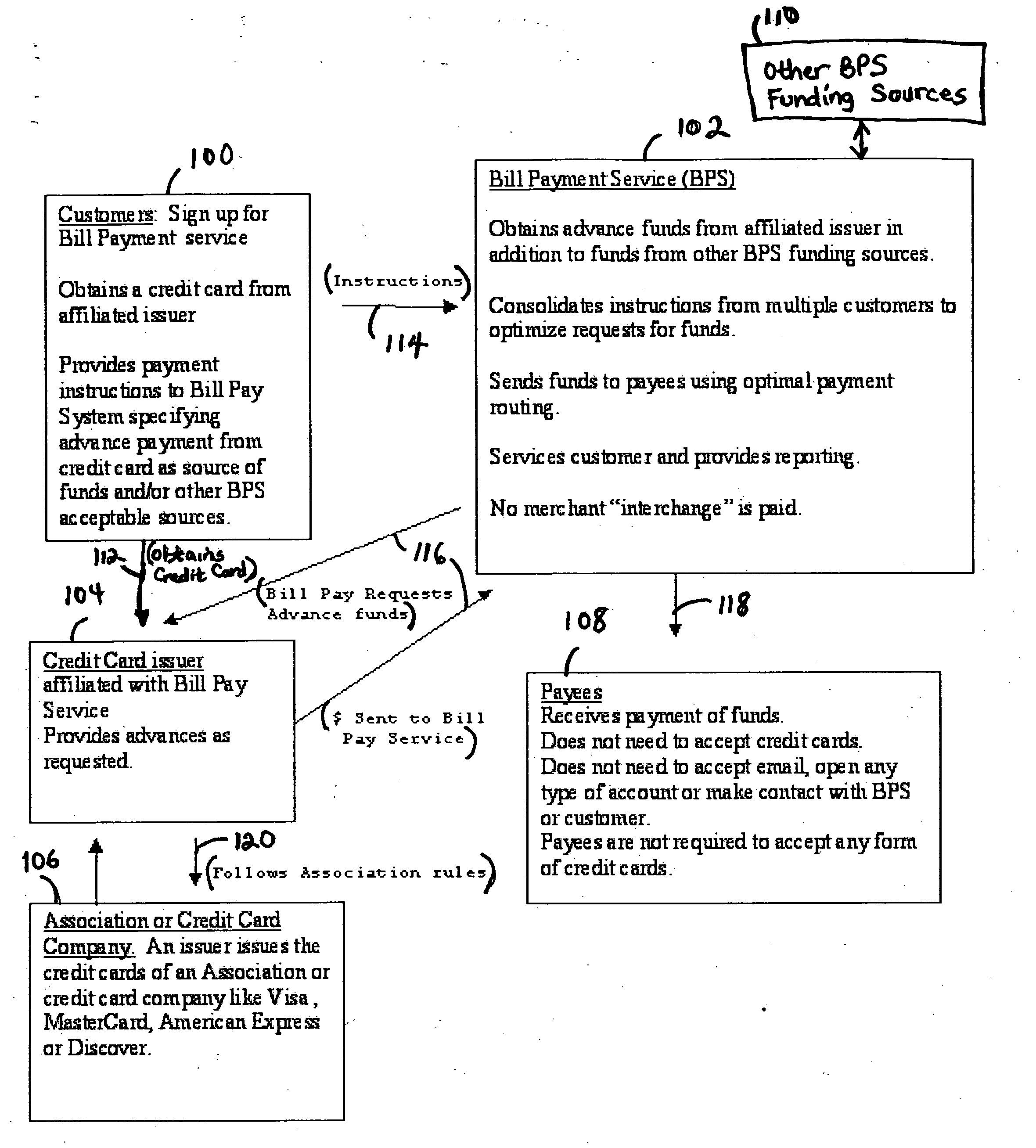

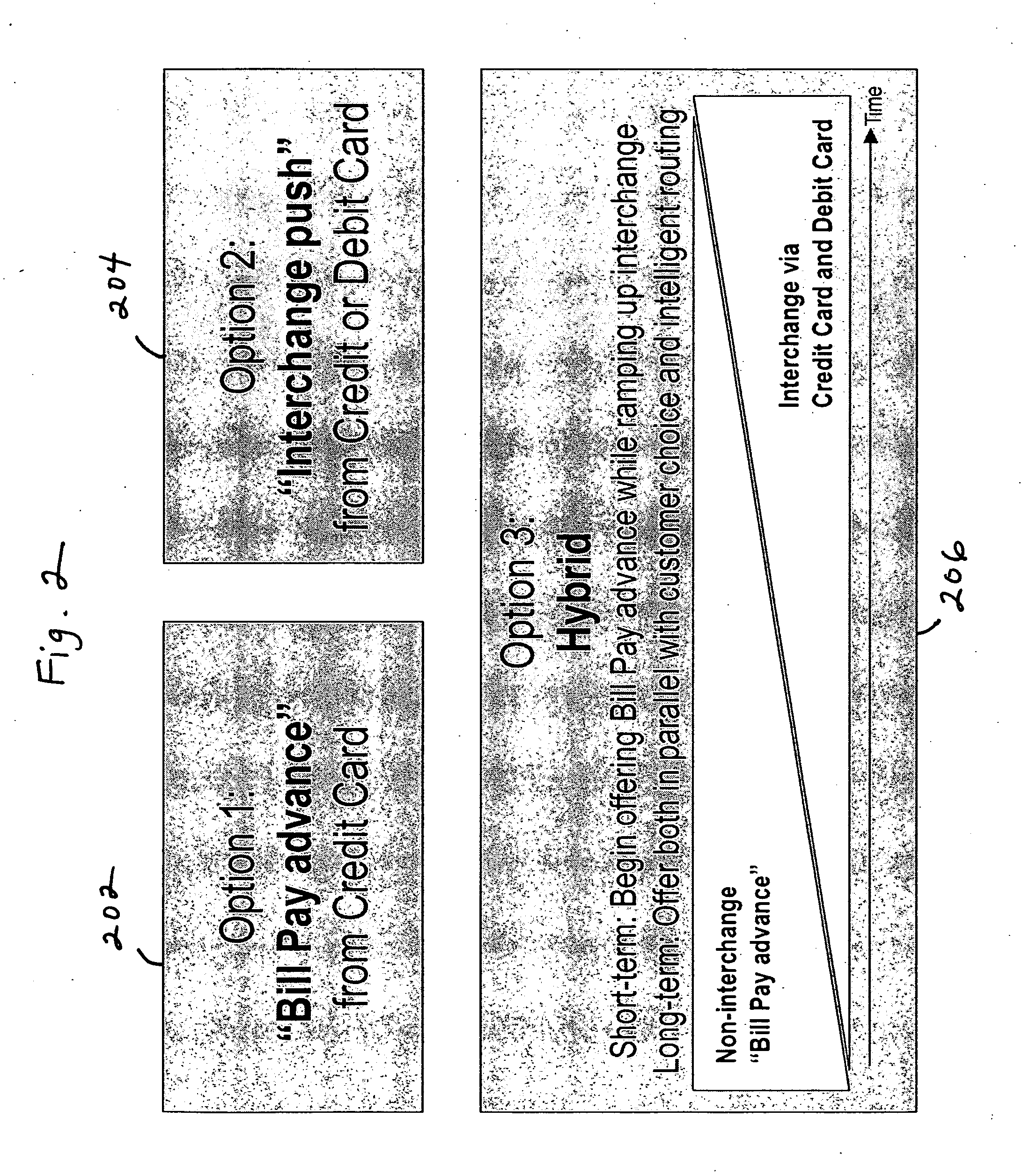

System and method for bill pay with credit card funding

An Internet based bill payment system and method is provided that allows a consumer to push payments and / or information to any payee from the consumer's credit card account. One embodiment of the invention allows the customer to make a payment to any payee from an enterprise credit card or any other credit account of the enterprise, referred to as “Bill Pay advance.” One embodiment of the invention is provided which allows an enterprise's consumer credit card customers to sign up for and use the enterprise's bill pay advance system, whether or not the consumer has a demand deposit account (DDA) account. The invention allows the customer to designate either source of funds for payment and for any payee they choose to pay. One embodiment of the invention offers an interchange push methodology with customer choice of the payment source of funds and intelligent routing.

Owner:WELLS FARGO BANK NA

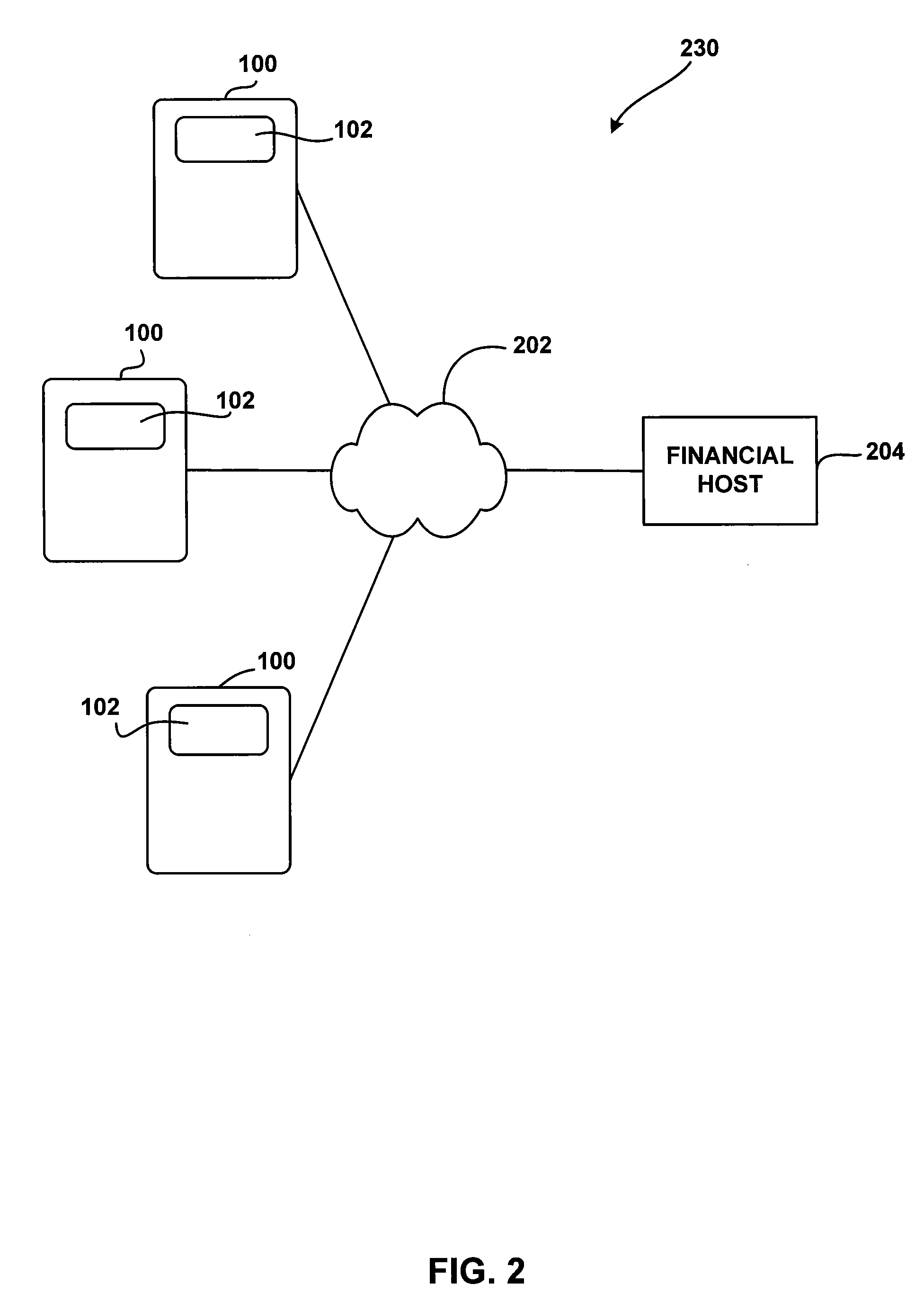

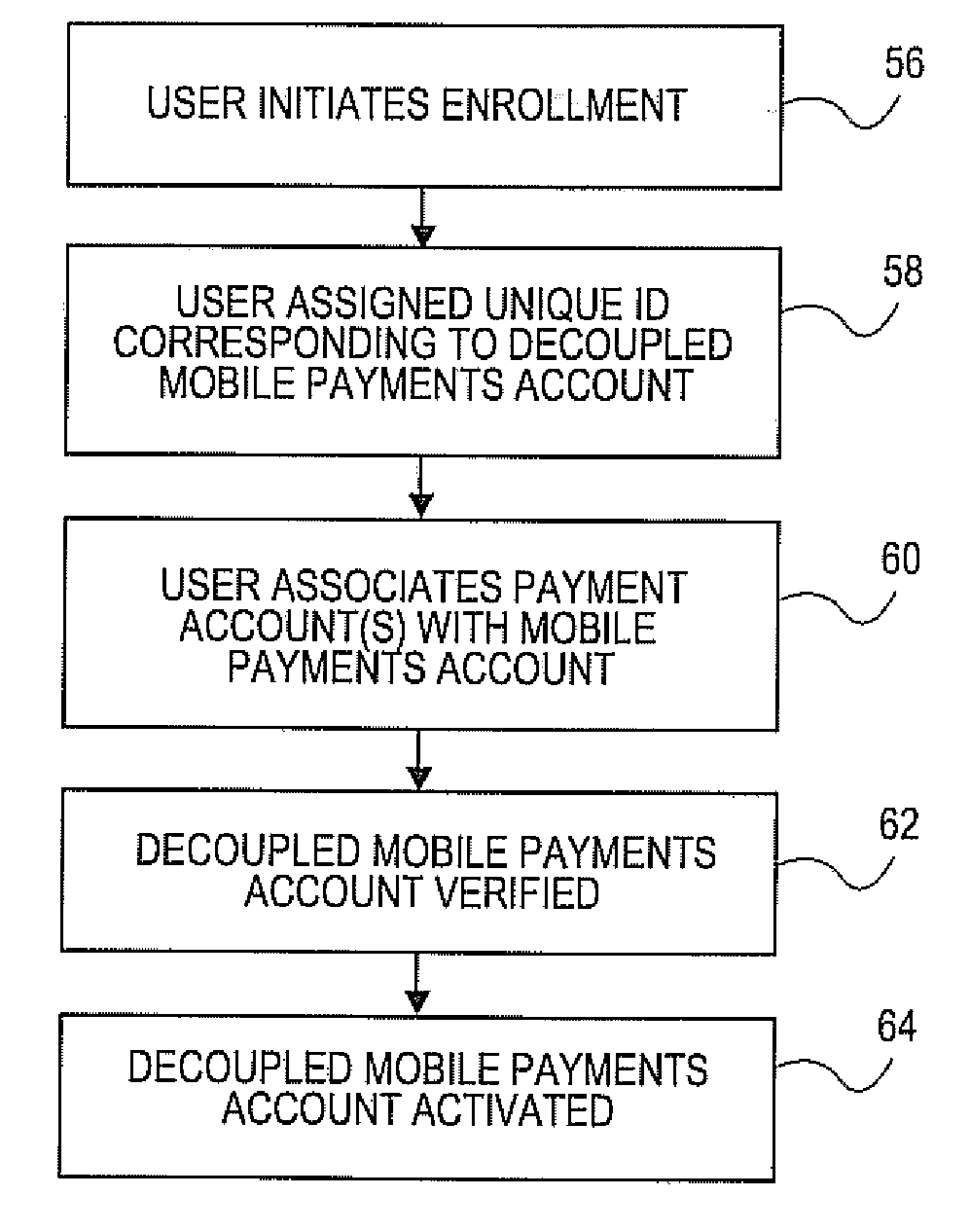

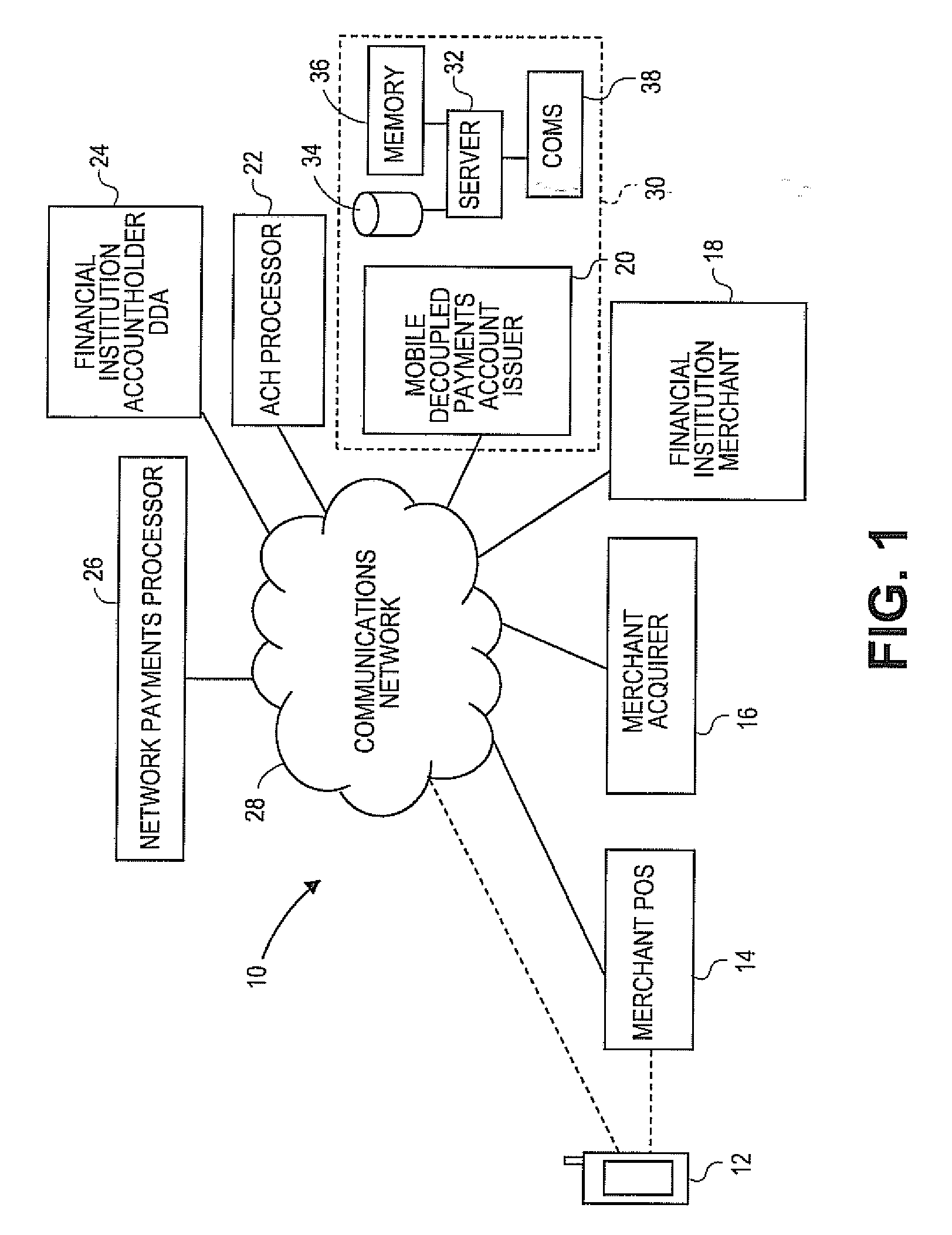

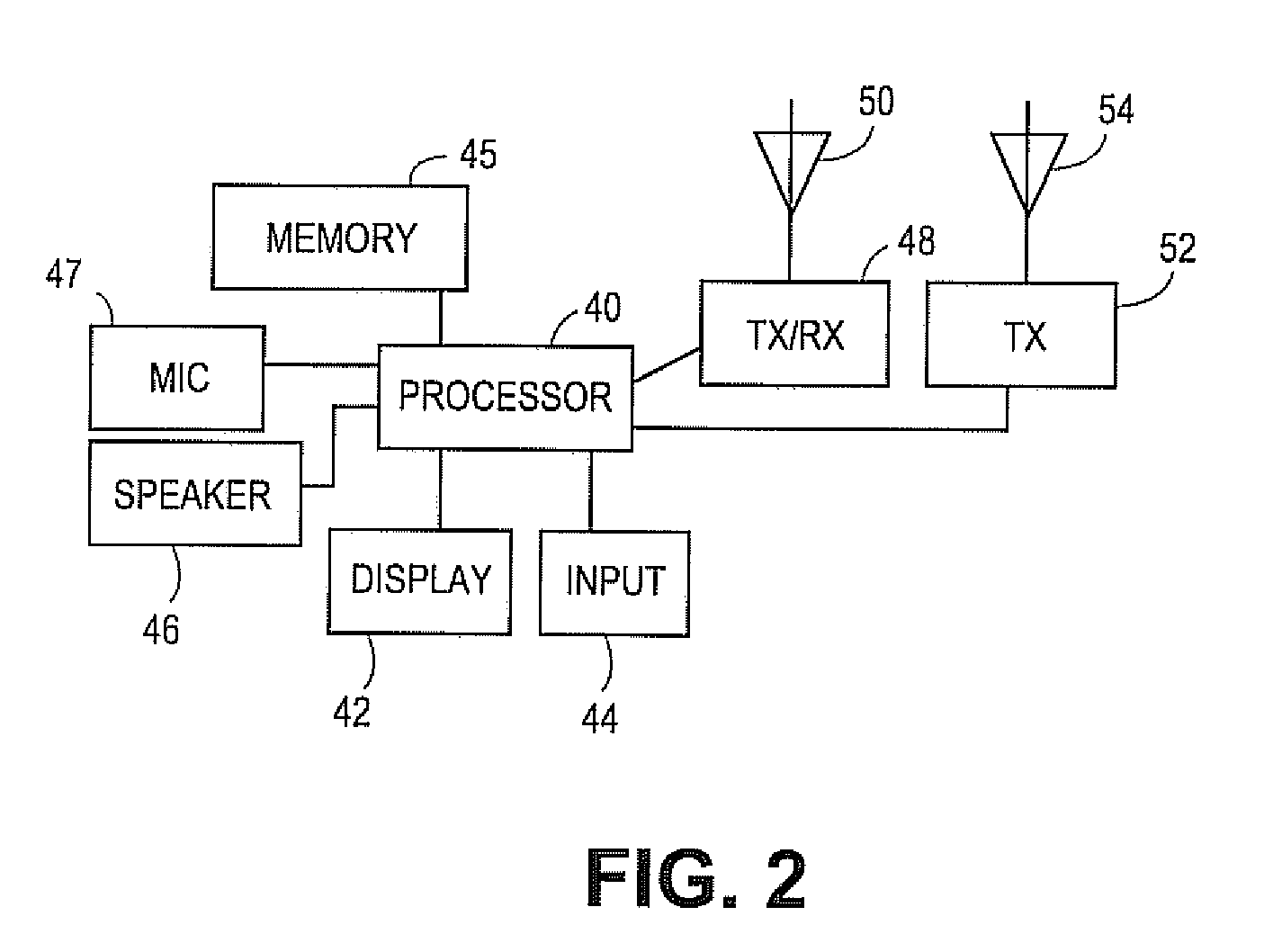

Systems, methods and devices for facilitating mobile payments

Mobile decoupled payments account systems and computer-implemented methods provide a decoupled mobile payments account and processing for payments made with a decoupled mobile payments account. A demand deposit account of an accountholder is associated with a decoupled mobile payments account that enables a mobile device to be used in making proximity or remote payments. Embodiments include mobile decoupled payments accounts based upon open or closed loop processing networks and mobile decoupled payments accounts that are ACH-direct accounts. An issuer of the mobile decoupled payments account authorizes or declines transactions and, for approved transactions, initiates an ACH transaction to obtain funds corresponding to an approved purchase transaction from the demand deposit account of the accountholder. Embodiments include person-to-person mobile payments and merchant-specific gifts and prioritized selection of accounts associated with a decoupled mobile payments account for processing a purchase transaction made with a mobile device.

Owner:GOFIGURE PAYMENTS

Bank account automatic adjustment system

InactiveUS7509287B2More balancedMinimize as littleFinanceComputer security arrangementsDeposit accountBank account

The present system for automatically adjusting deposit balance is the effective measure for pay-off which calculates the excess amount by subtracting from the balance of the account established in one financial institution, the specified balance for the account and calculates the allowable amount by subtracting from the specified balance for the account established in other financial institution, the balance of the account and compares said excess amount with said allowable amount and sets the transfer amounts as the one lesser of either said excess amount or said allowable amount. Specifically the system for automatically adjusting deposit sets in addition the plus specified balance for checking and savings accounts and time deposit account respectively when said accounts include checking account and savings account and time deposit accounts. The system for automatically adjusting deposit further sets the minus specified balance for the debt amount. Preferably the system for automatically adjusting deposit is an apparatus which enables to maintain the necessary balance and calculates the deficit amount by subtracting from the balance for the account established in one financial institution, the necessary balance for the account and calculates the surplus amount by subtracting from the necessary balance for the account established in said other financial institution, the balance for the account and compares said deficit amount with the surplus amount and sets the amount that is lesser of said deficit or surplus amounts for the transfer amount.

Owner:NUTAHARA ATSUO +1

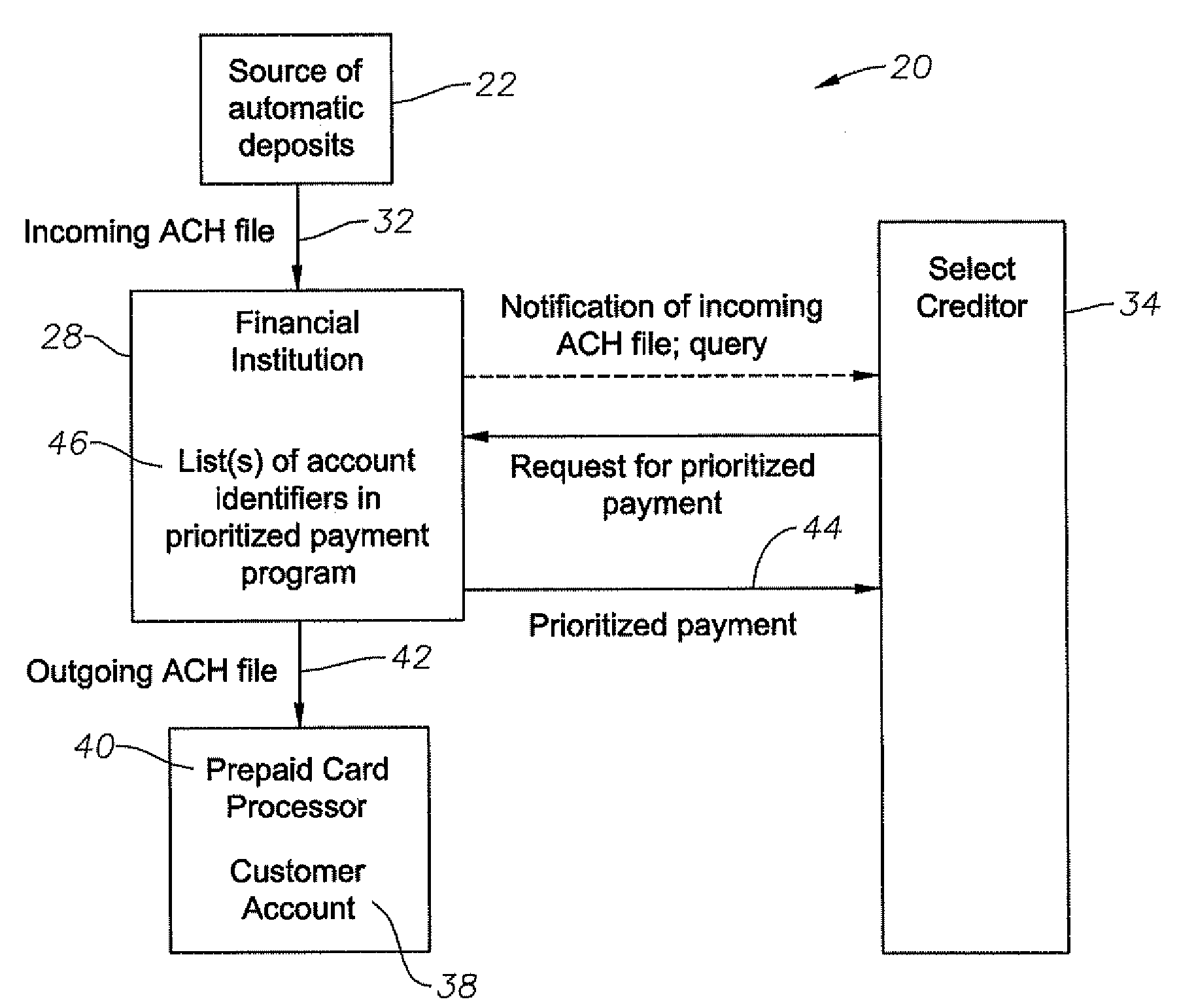

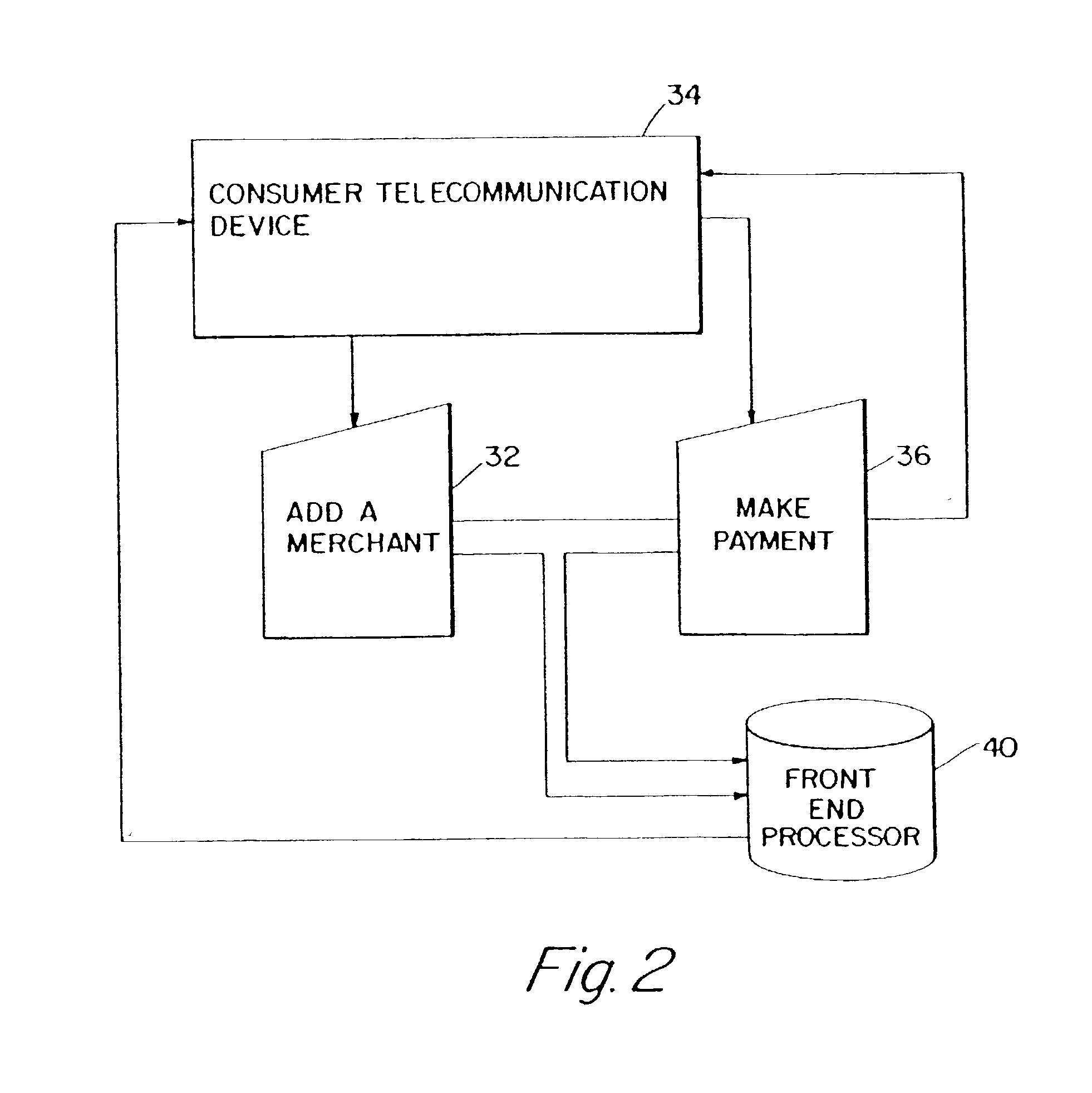

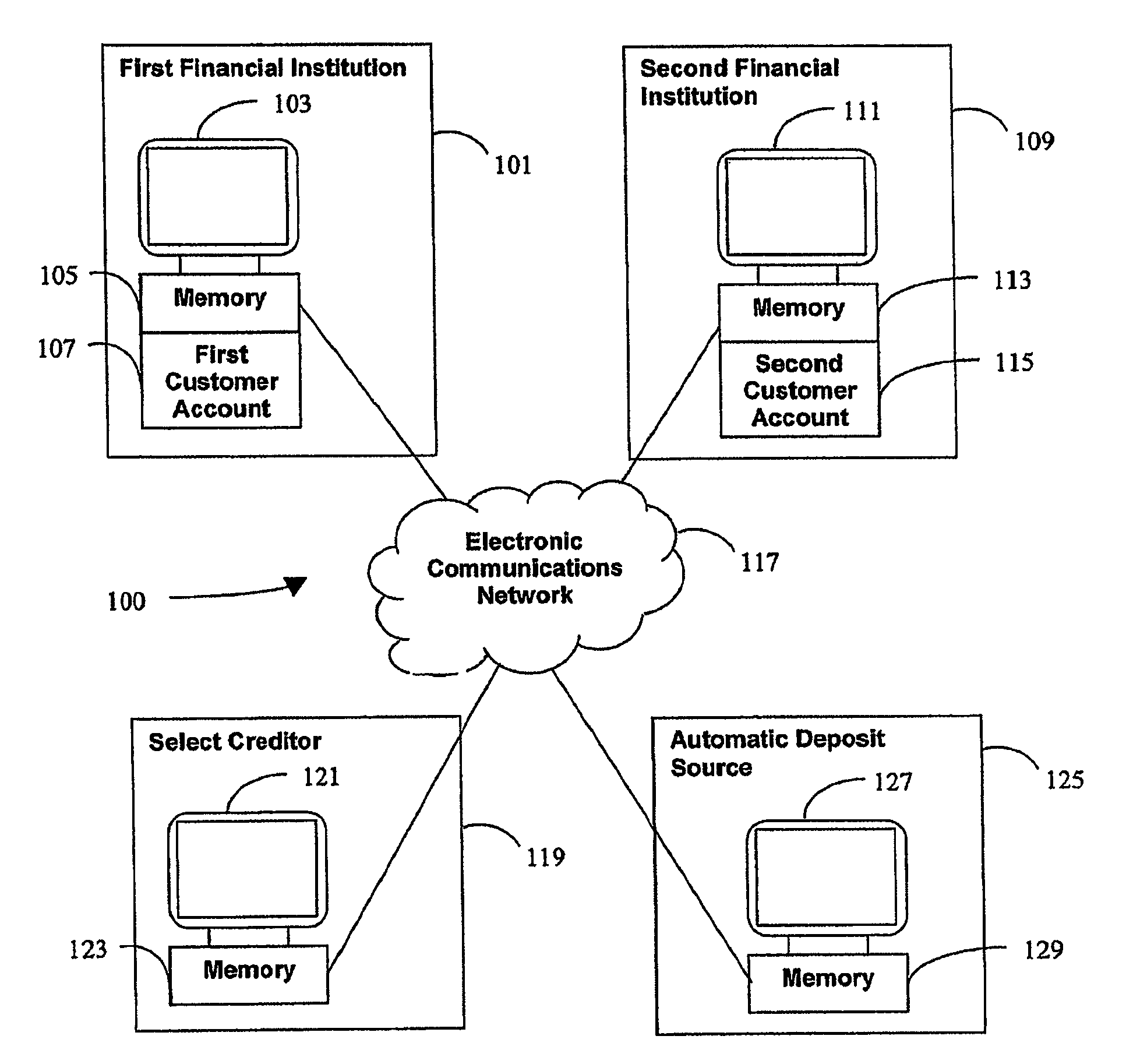

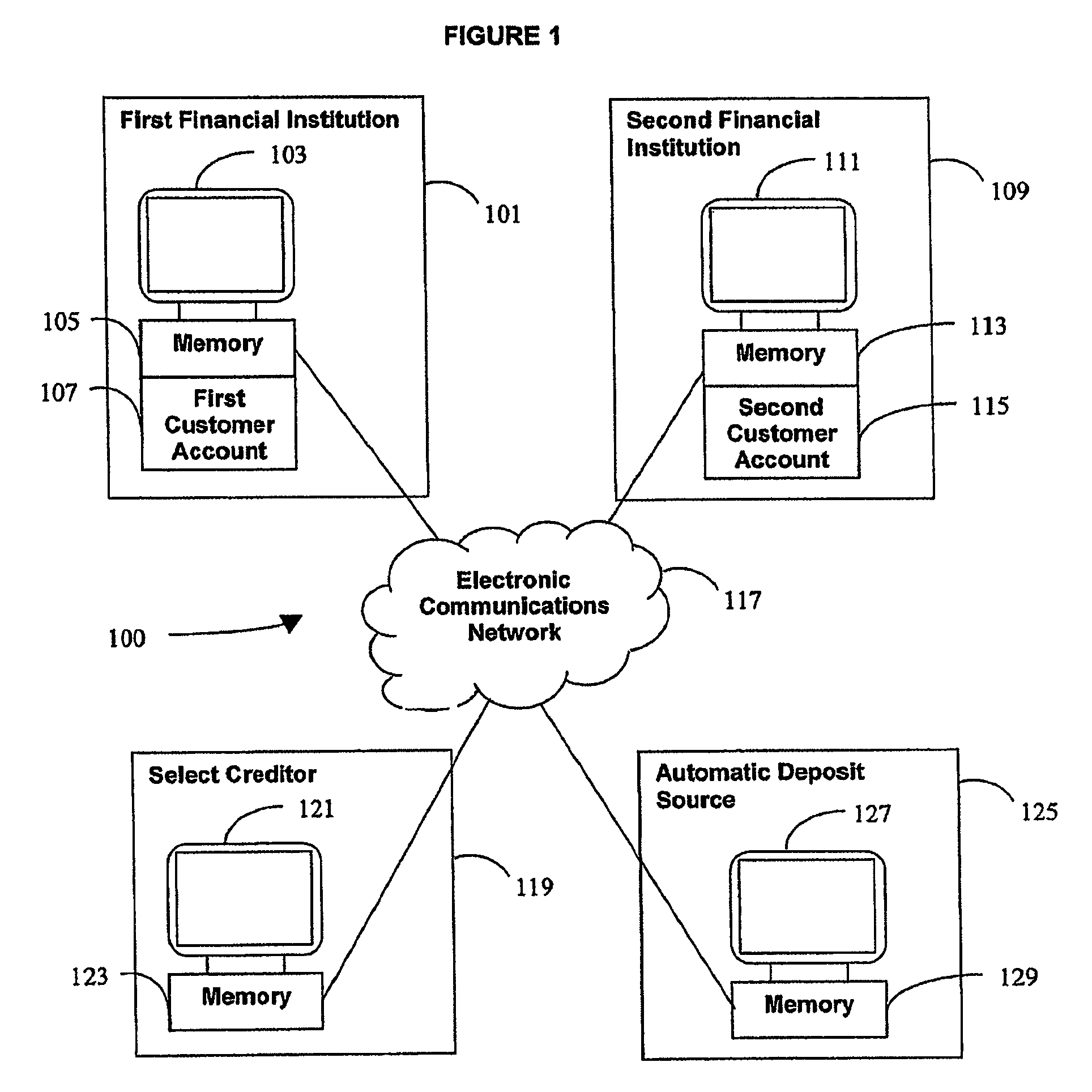

Transfer Account Systems, Computer Program Products, And Associated Computer-Implemented Methods

ActiveUS20090164370A1Small rateReduce riskFinancePoint-of-sale network systemsDeposit accountComputer maintenance

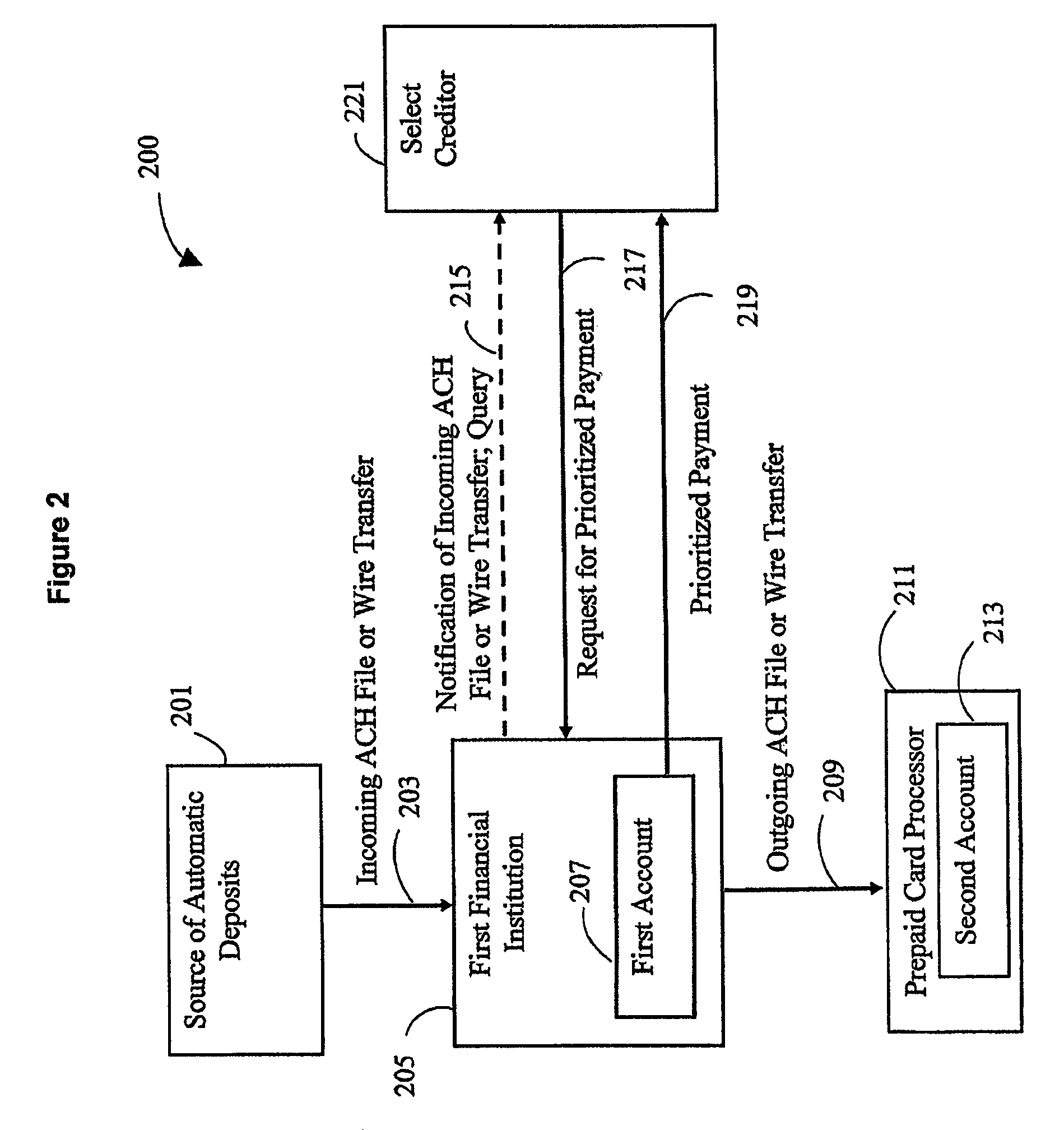

A financial institution computer maintains a list of account identifiers for accounts enrolled in a prioritized payment program including pre-authorization of certain payment requests by select creditors. The computer estimates a value of prioritized payments and authorizes a sweep payment to the customer account from a stand-in account at a payroll processor, so that the estimated value is held back in the stand-in account. The financial institution computer then receives an incoming ACH file, including an automatic deposit destined for the customer account. The computer generates an outgoing ACH file with both an entry for an automatic deposit destined for the customer account and an entry for a pre-authorized prioritized payment to a select creditor, so that the automatic deposit is credited and relatively instantaneously any prioritized payment is debited from the customer account. The customer account can be, for example, a demand deposit account or a prepaid card account.

Owner:PATHWARD NAT ASSOC

Payment processing utilizing alternate account identifiers

A technique for making a payment for a payor is provided. The technique includes receiving a request to make a payment to a payee for the payor. An account identifier which is associated with a deposit account belonging to the payee is identified based upon processing of the received payment request. The account identifier is not a deposit account number assigned to the deposit account by the financial institution at which the deposit account is maintained. A payment is then directed to the payee's deposit account utilizing the identified account identifier.

Owner:CHECKFREE SERVICES CORP

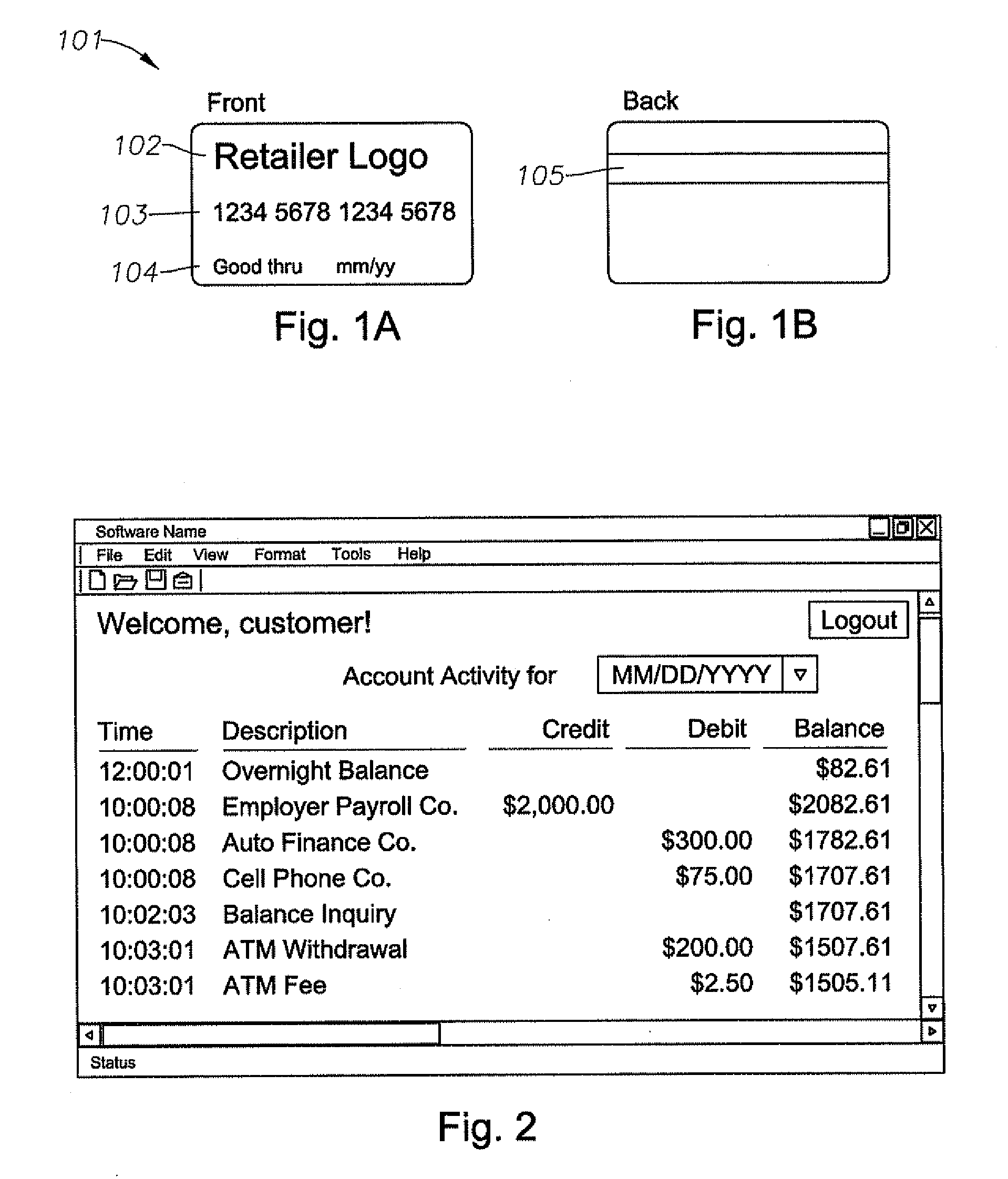

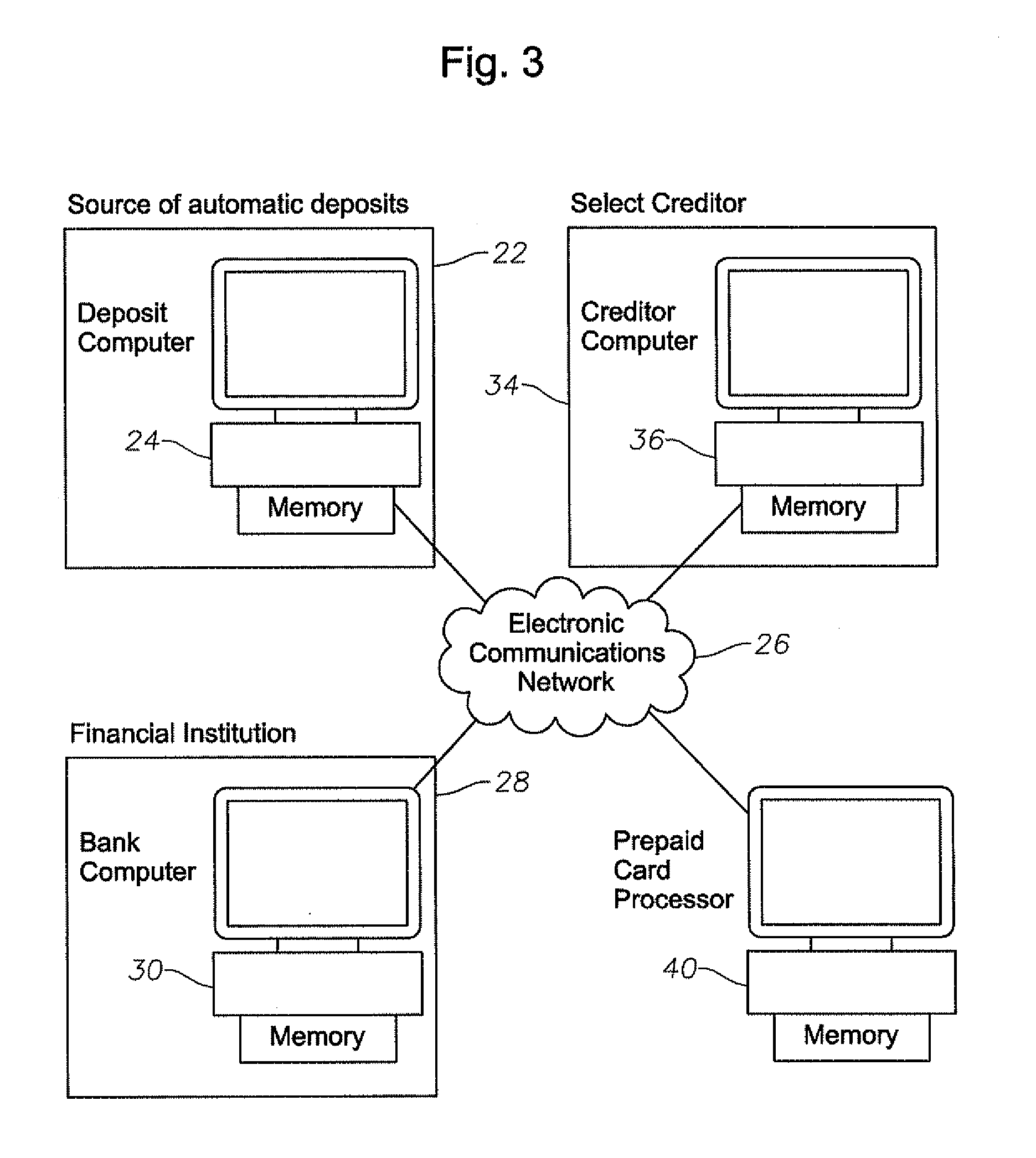

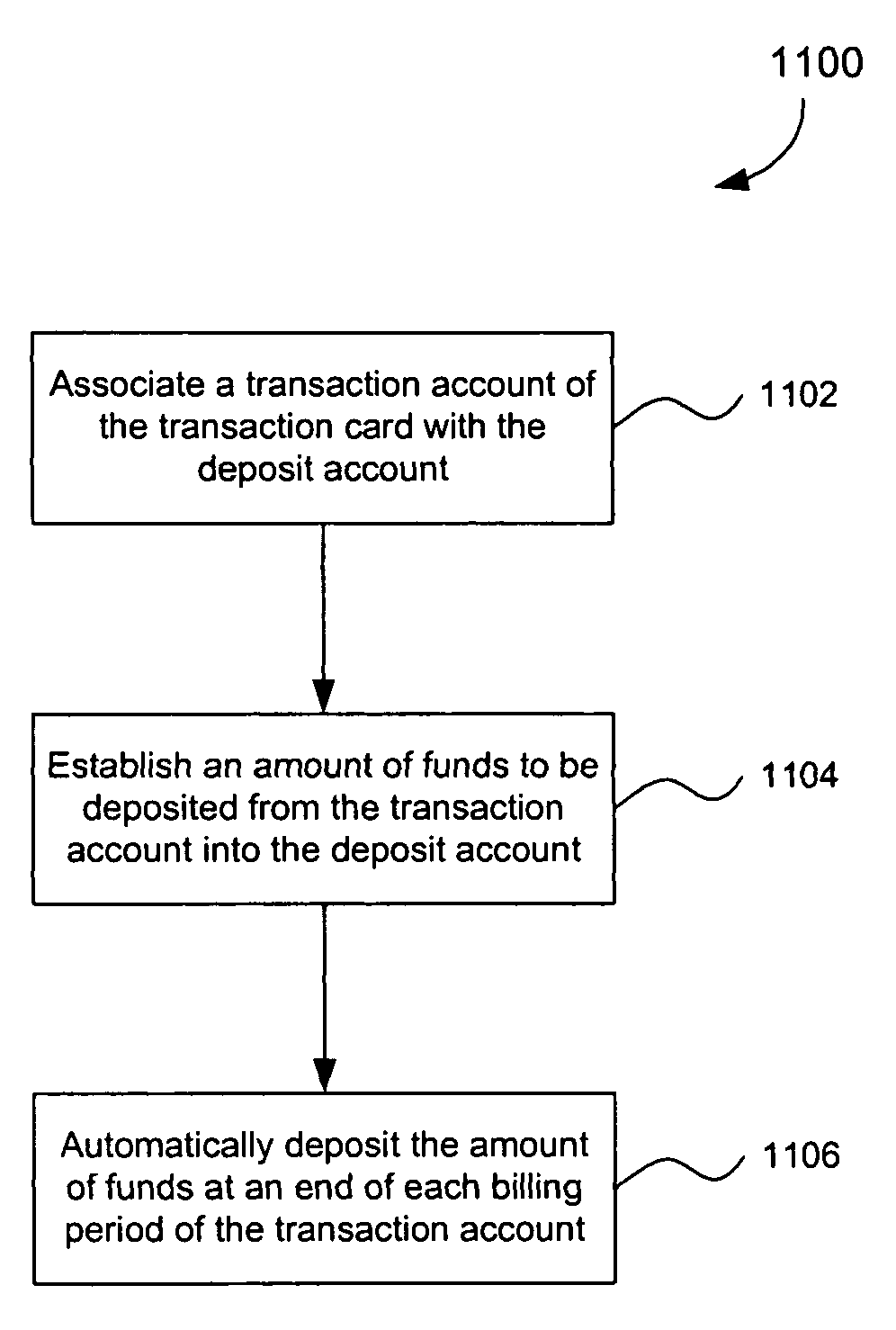

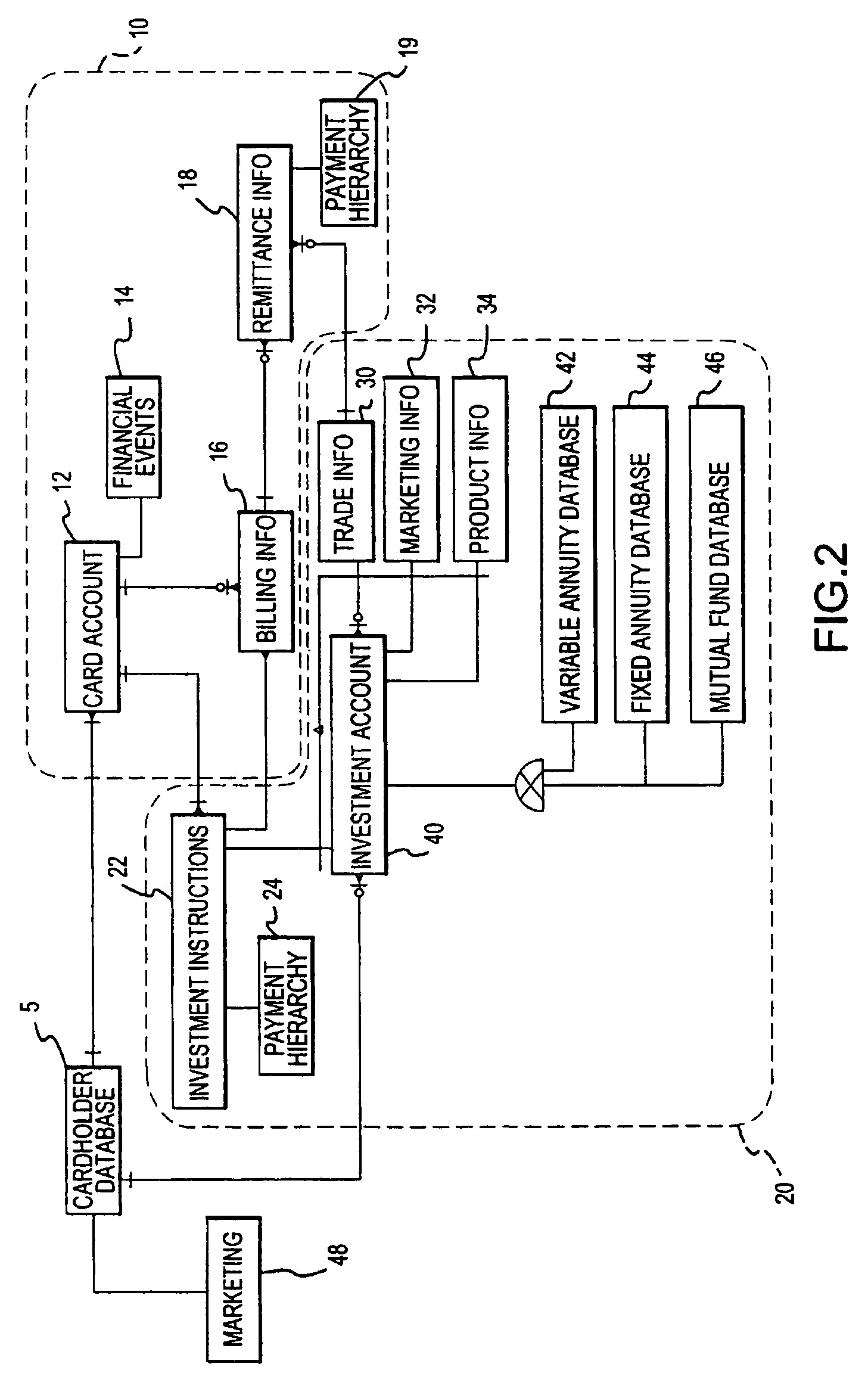

System, method, and computer program product for saving and investing through use of transaction cards

A system, method, and computer program product are used for saving through use of transaction cards. This is done through associating a transaction account of the transaction card with one or more deposit accounts. An amount of funds to be deposited from the transaction account into the deposit account is established. A number of times a deposit will be made is established. A time duration between the deposits when more than one deposit will be made is established. An event that initiates at least a first one of the deposits is established. The amount of funds from the transaction card account is deposited into the deposit account based on the above criteria.

Owner:LIBERTY PEAK VENTURES LLC

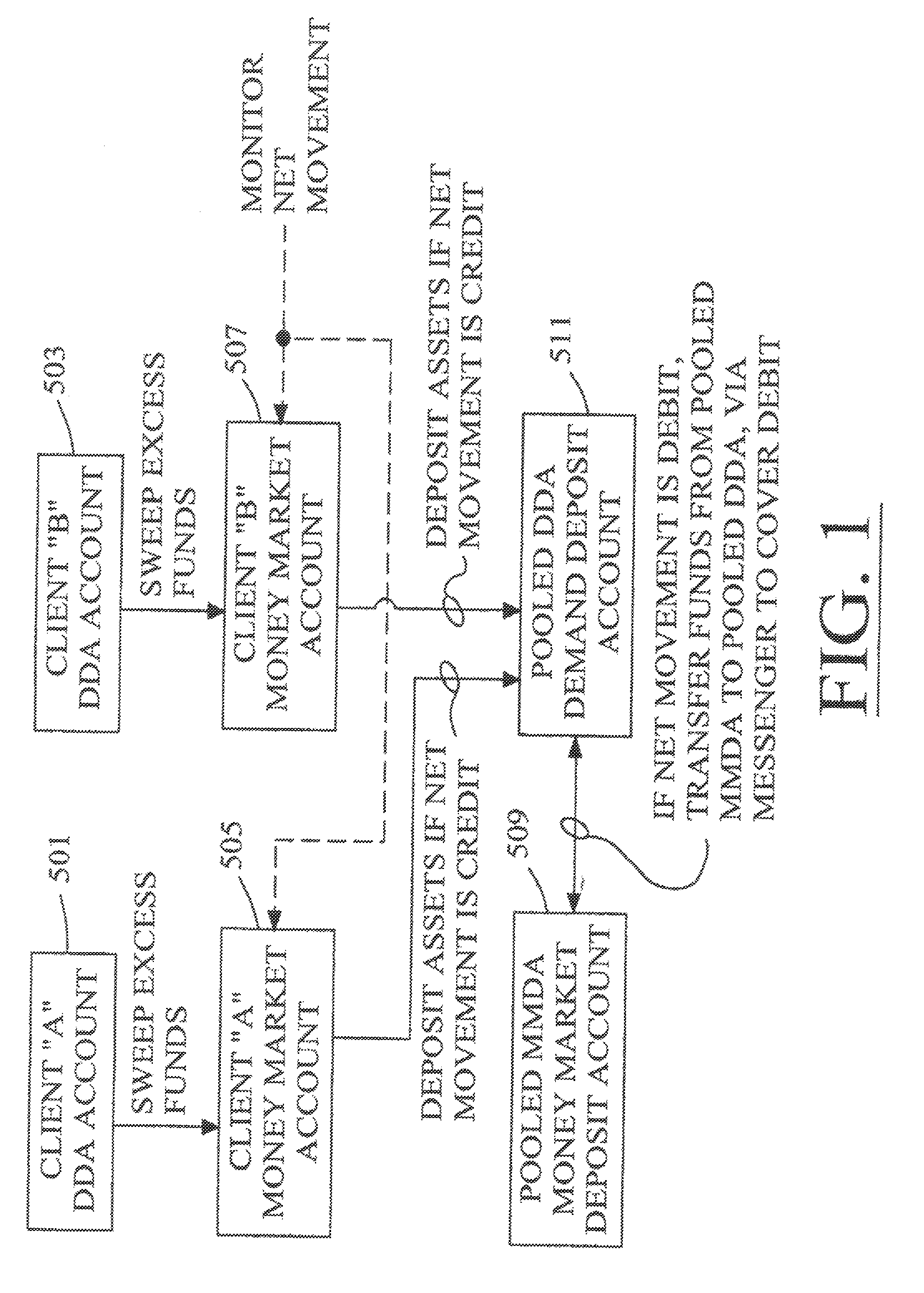

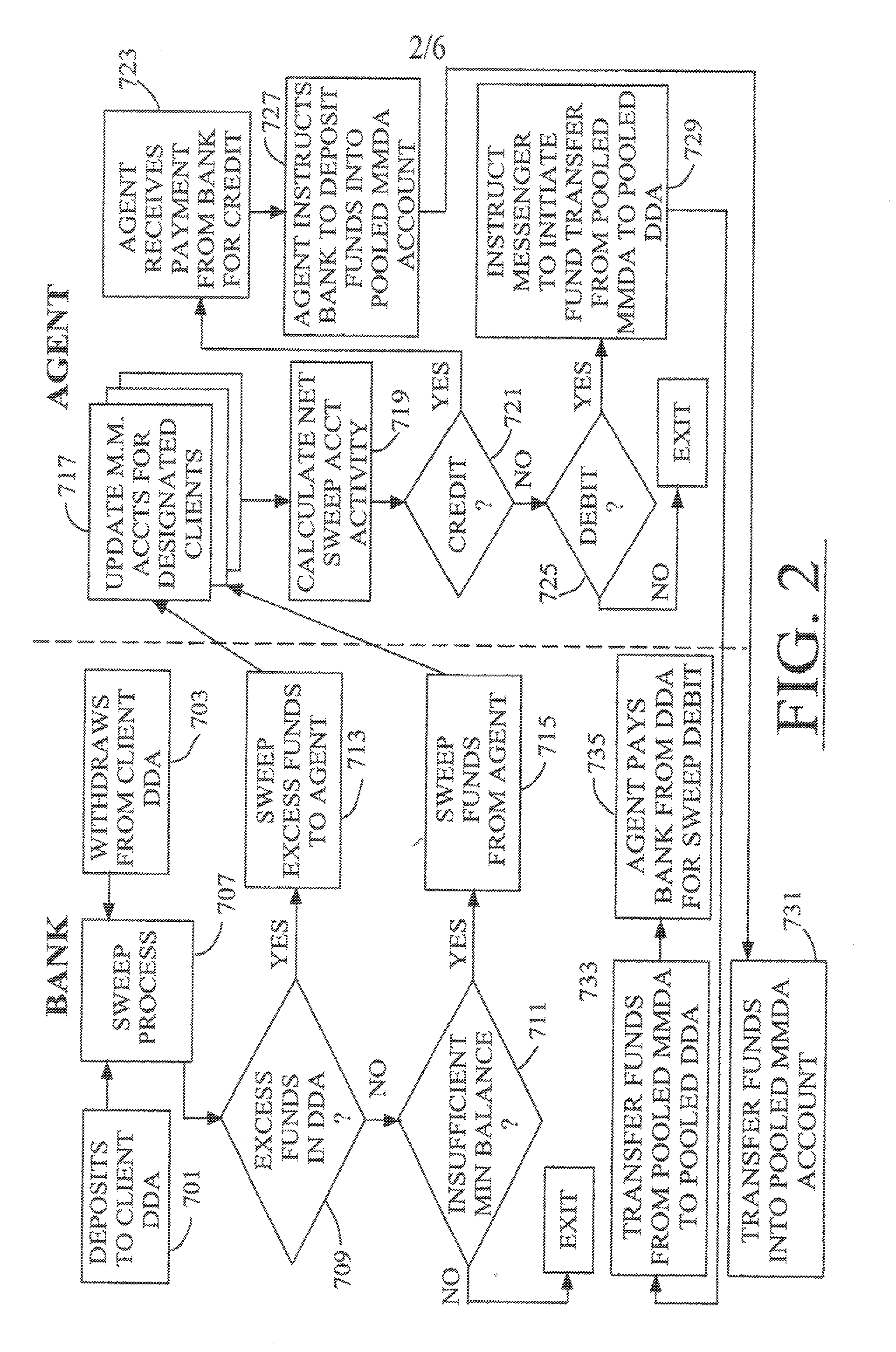

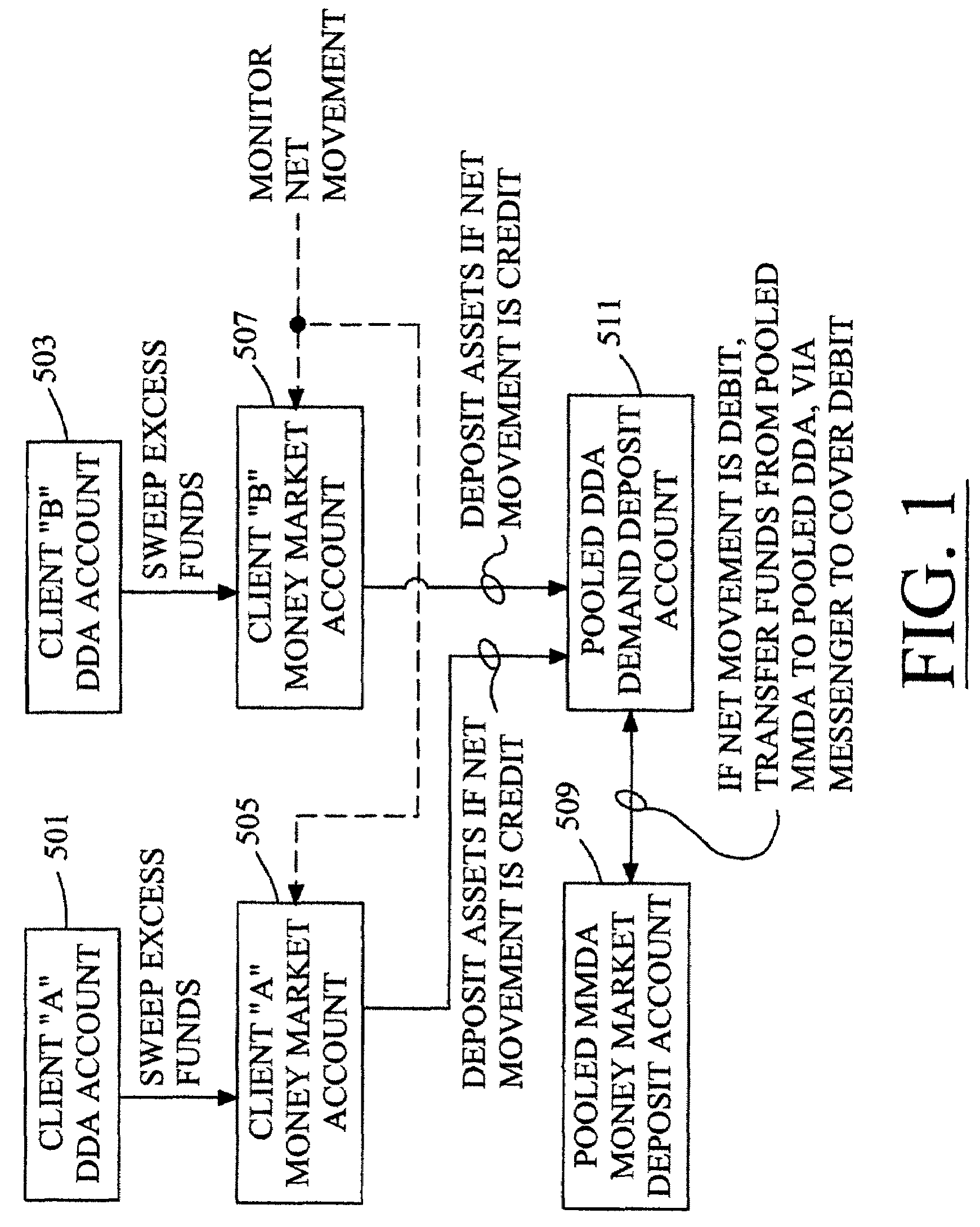

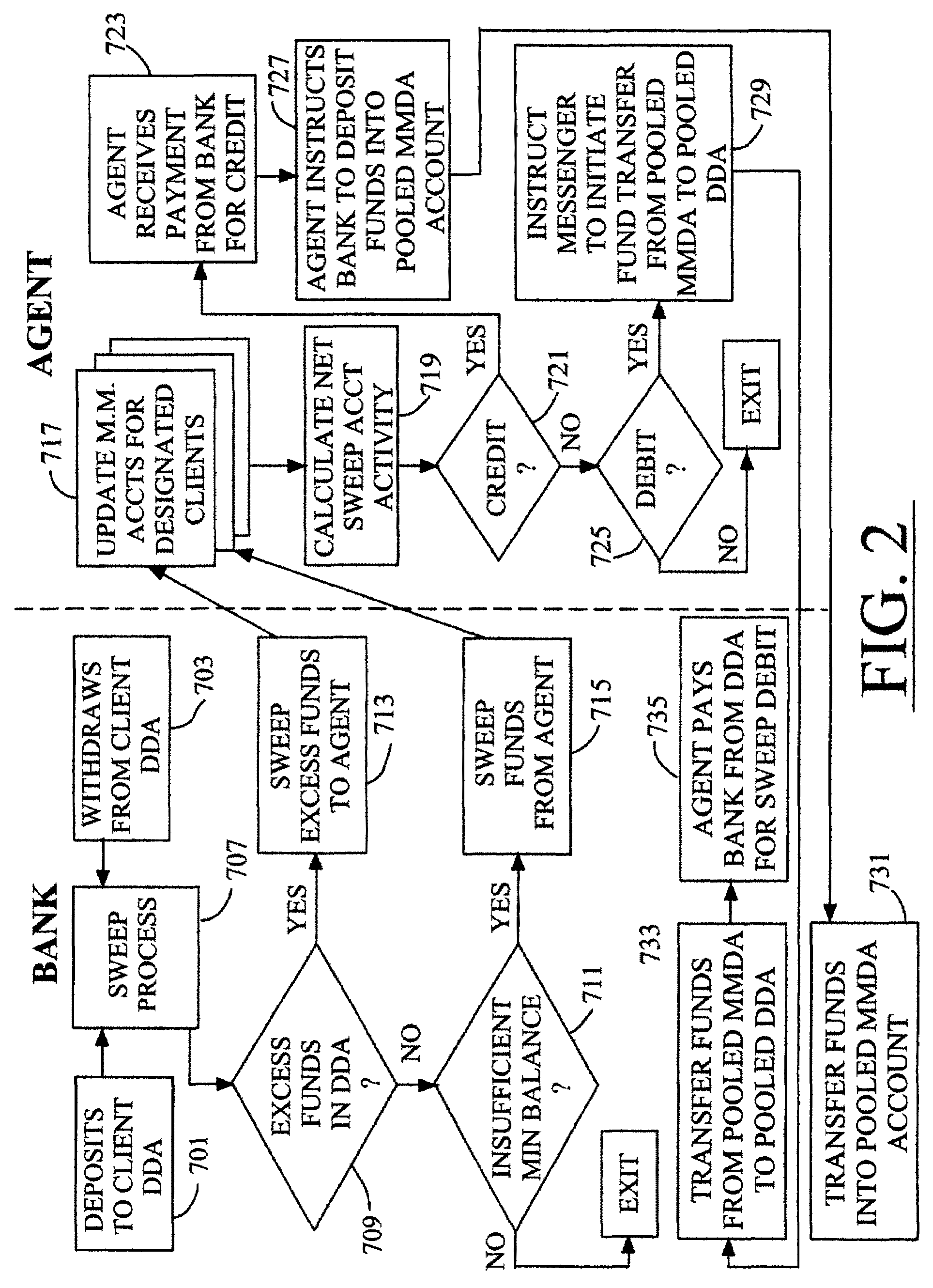

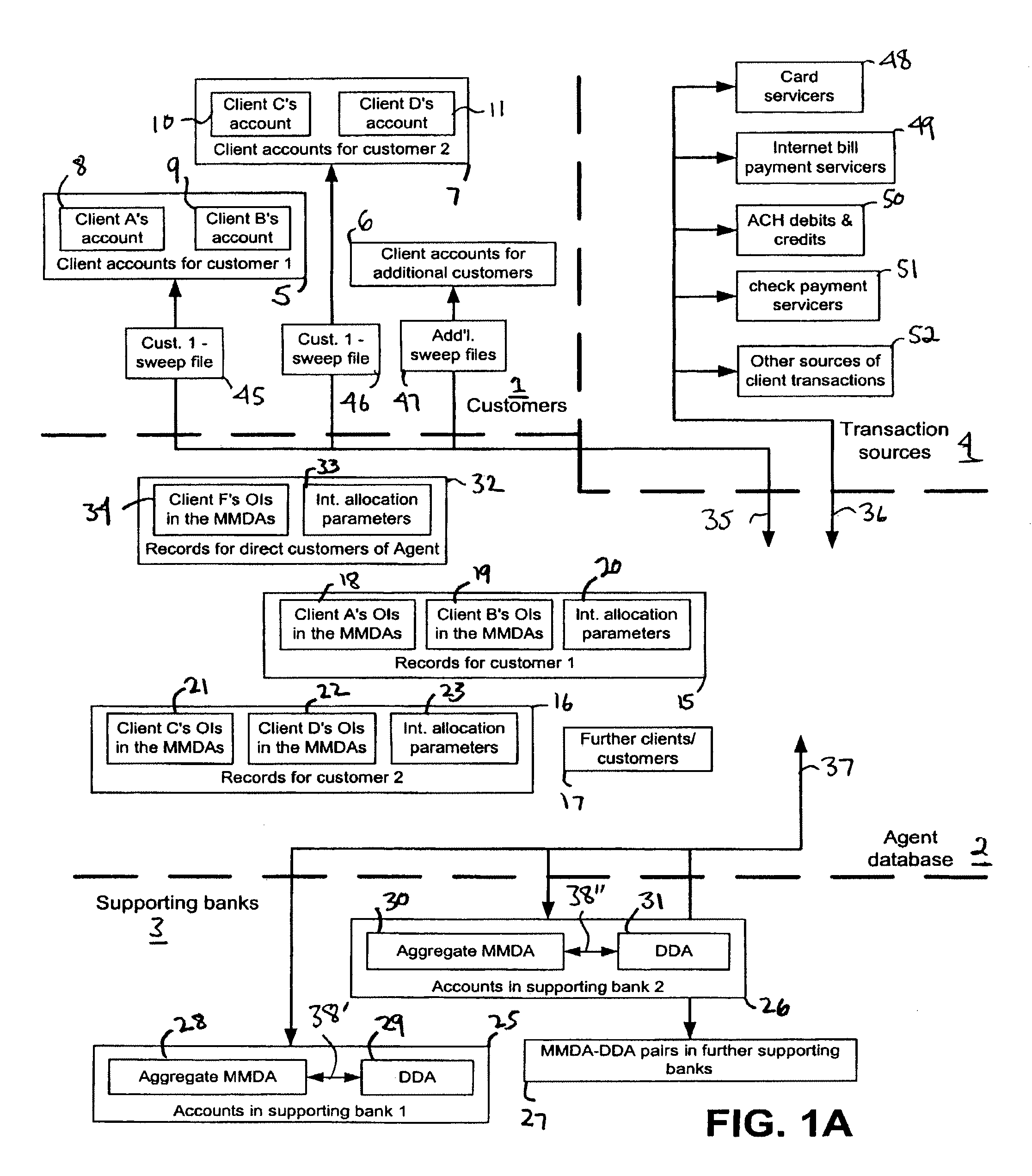

Systems and methods for adminstering return sweep accounts

Abstract of the DisclosureNovel systems and methods for managing a plurality of client demand accounts so as to allow a banking institution to retain client deposits on the bank’s balance sheets while, at the same time, providing the client with the capability of implementing up to an unlimited number of transactions per month and also providing the client with interest on their account balances. These objectives are achieved through the use of a pooled deposit account at the client’s savings institution or bank. Funds are transferred from individual client demand accounts to the pooled insured deposit account. All or a portion of the interest accrued from the pooled deposit account is then distributed to individual clients. The interest may, but need not, be distributed according to the relative proportions of each client’s funds in the pooled deposit account. A database keeps track of deposits to, and withdrawals from, each of the client demand accounts, as well as each client’s proportionate and / or monetary share in the pooled deposit account. On a regular, periodic, or recurring basis, a net transaction is calculated as the sum of individual client deposits and withdrawals from the plurality of demand accounts. The net transaction calculation is used to determine an amount of funds that need to be deposited into the pooled deposit account to cover client deposits, or an amount of funds that needs to be withdrawn from the pooled deposit account to cover client withdrawals. Individual account management calculations are performed to determine whether to deposit or withdraw funds from the pooled deposit account to each of a plurality of individual client demand accounts. The database is updated for each client’s deposit and withdrawal activities. The invention permits funds to be deposited into a demand account from various sources, and also provides for the tendering of payments from the demand account via different instruments, without limitation as to the number of transfers, and with accrual of interest on the deposited funds.

Owner:ISLAND INTPROP

Systems and methods for administering return sweep accounts

Novel systems and methods for managing a plurality of client demand accounts so as to allow a banking institution to retain client deposits on the bank's balance sheets while, at the same time, providing the client with the capability of implementing up to an unlimited number of transactions per month and also providing the client with interest on their account balances. These objectives are achieved through the use of a pooled deposit account at the client's savings institution or bank. Funds are transferred from individual client demand accounts to the pooled insured deposit account. All or a portion of the interest accrued from the pooled deposit account is then distributed to individual clients. The interest may, but need not, be distributed according to the relative proportions of each client's funds in the pooled deposit account. A database keeps track of deposits to, and withdrawals from, each of the client demand accounts, as well as each client's proportionate and / or monetary share in the pooled deposit account. On a regular, periodic, or recurring basis, a net transaction is calculated as the sum of individual client deposits and withdrawals from the plurality of demand accounts. The net transaction calculation is used to determine an amount of funds that need to be deposited into the pooled deposit account to cover client deposits, or an amount of funds that needs to be withdrawn from the pooled deposit account to cover client withdrawals. Individual account management calculations are performed to determine whether to deposit or withdraw funds from the pooled deposit account to each of a plurality of individual client demand accounts. The database is updated for each client's deposit and withdrawal activities. The invention permits funds to be deposited into a demand account from various sources, and also provides for the tendering of payments from the demand account via different instruments, without limitation as to the number of transfers, and with accrual of interest on the deposited funds.

Owner:ISLAND INTPROP

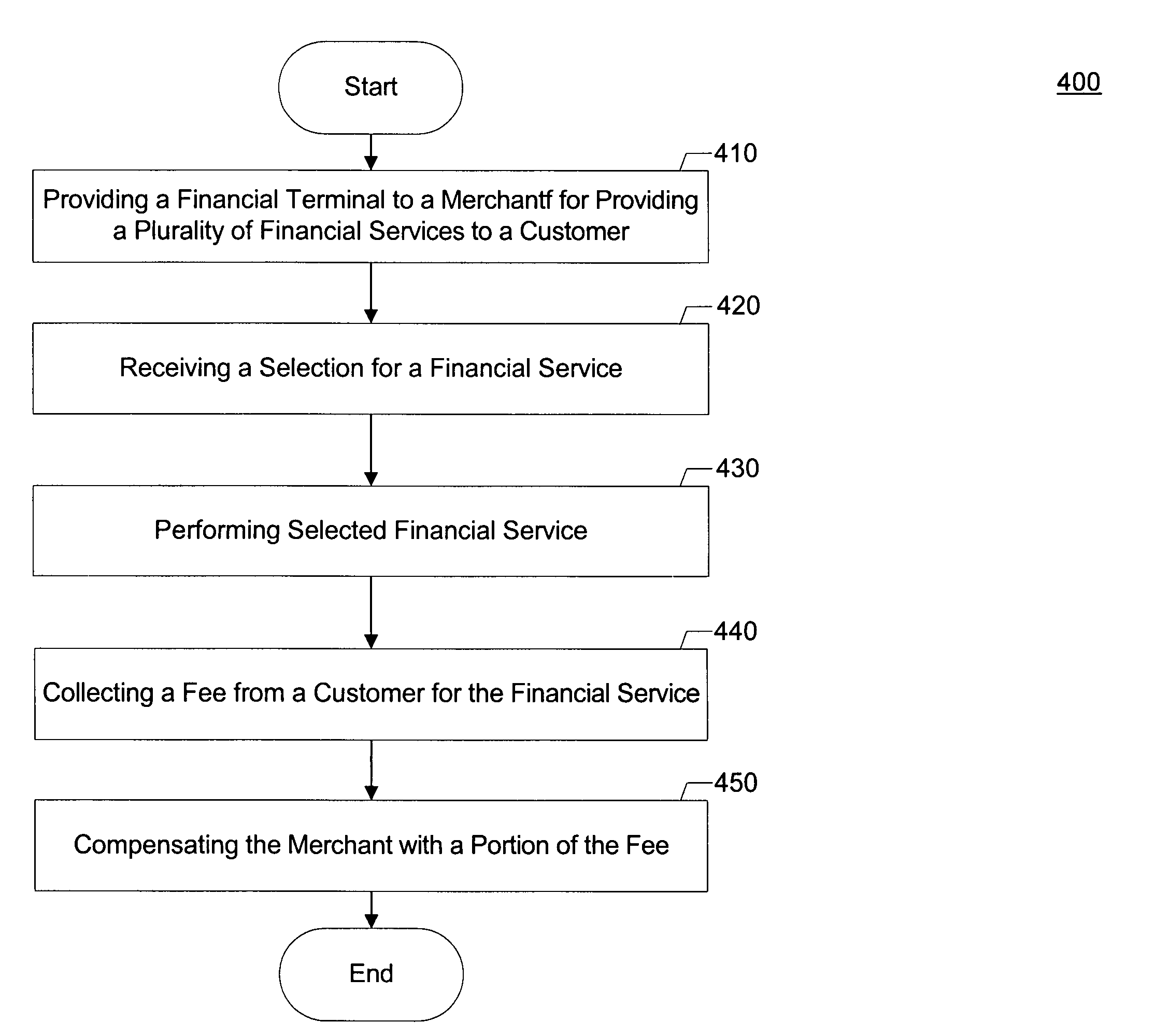

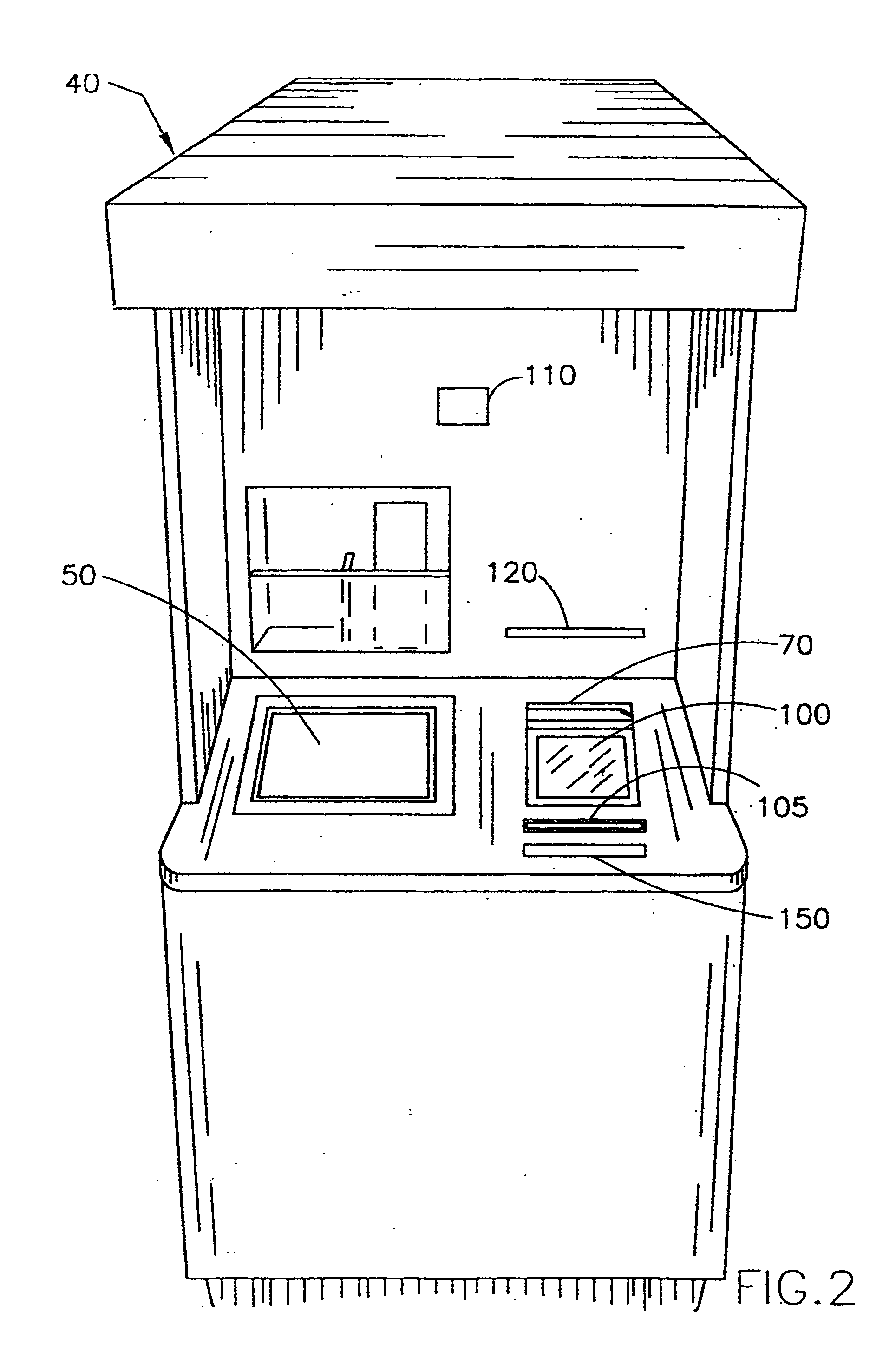

System, method and apparatus for providing financial services

The present invention is a system, method and apparatus for a terminal capable of accepting debit / credit or ATM cards, checks, money orders, cashiers checks, travelers checks, as well as a drivers license, state identification card, birth certificate and additionally any type of information that may be inputted into the terminal such as, but not limited to, an individuals direct deposit account (DDA) number, savings account number, etc. to facilitate a purchase, transfer of funds, wire of funds, cash-back option, etc. at a merchant location. In addition, the present invention will allow an individual to purchase pre-paid credit-type cards, pre-paid telecom cards, stamps, etc. at the terminal.

Owner:COMPUCREDIT INTPROP HLDG CORP II

Payment processing with selective crediting

InactiveUS20040049456A1Easy to useEasy to implementFinancePayment circuitsDeposit accountOperating system

A technique for making a payment for a payor is provided. The technique includes receiving a request to make a payment to a payee for a payor. This request is processed to select a mode to electronically credit the payee. After the mode is selected an electronic credit is directed to the payee in the selected mode. A debit is also directed from a deposit account associated with the payor.

Owner:CHECKFREE SERVICES CORP

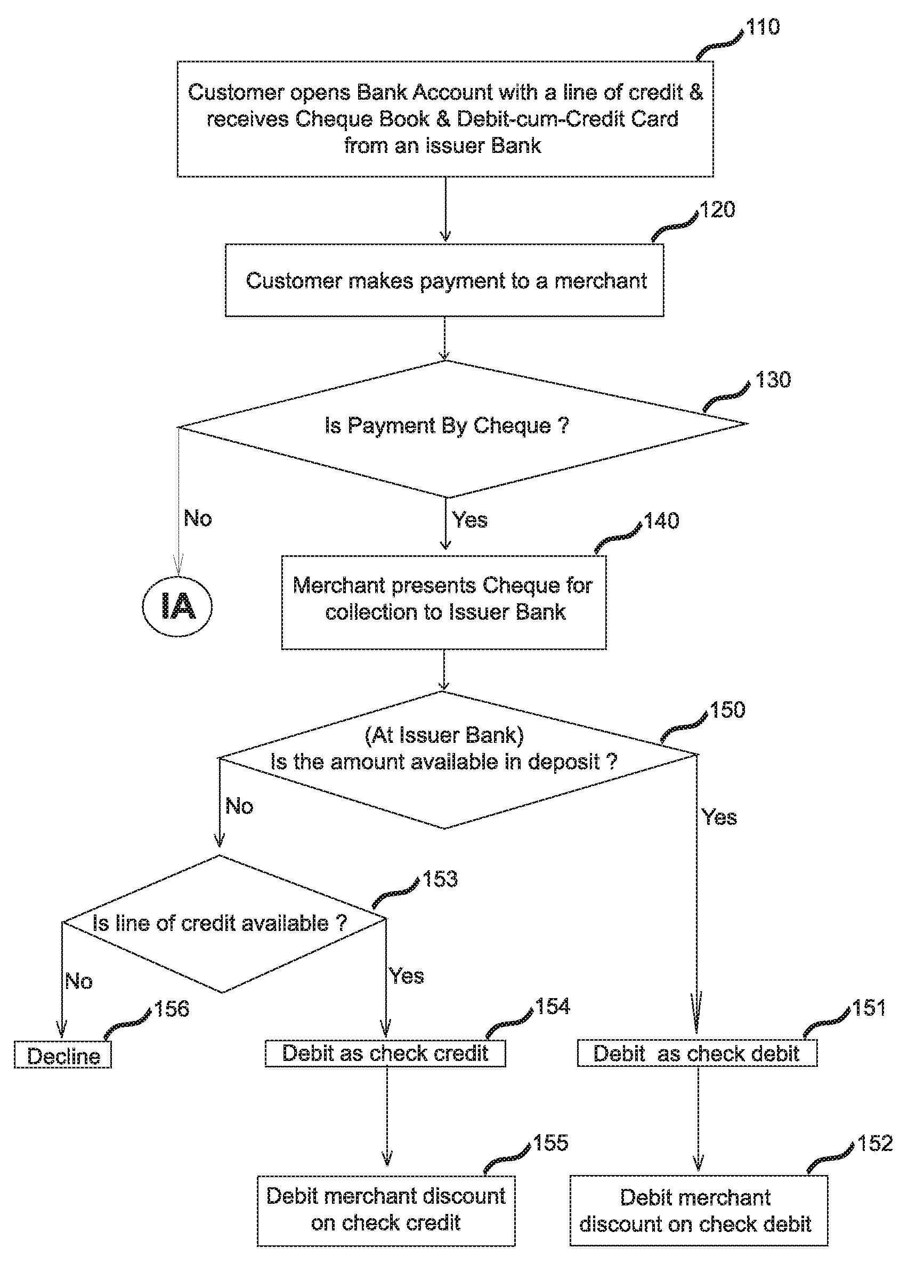

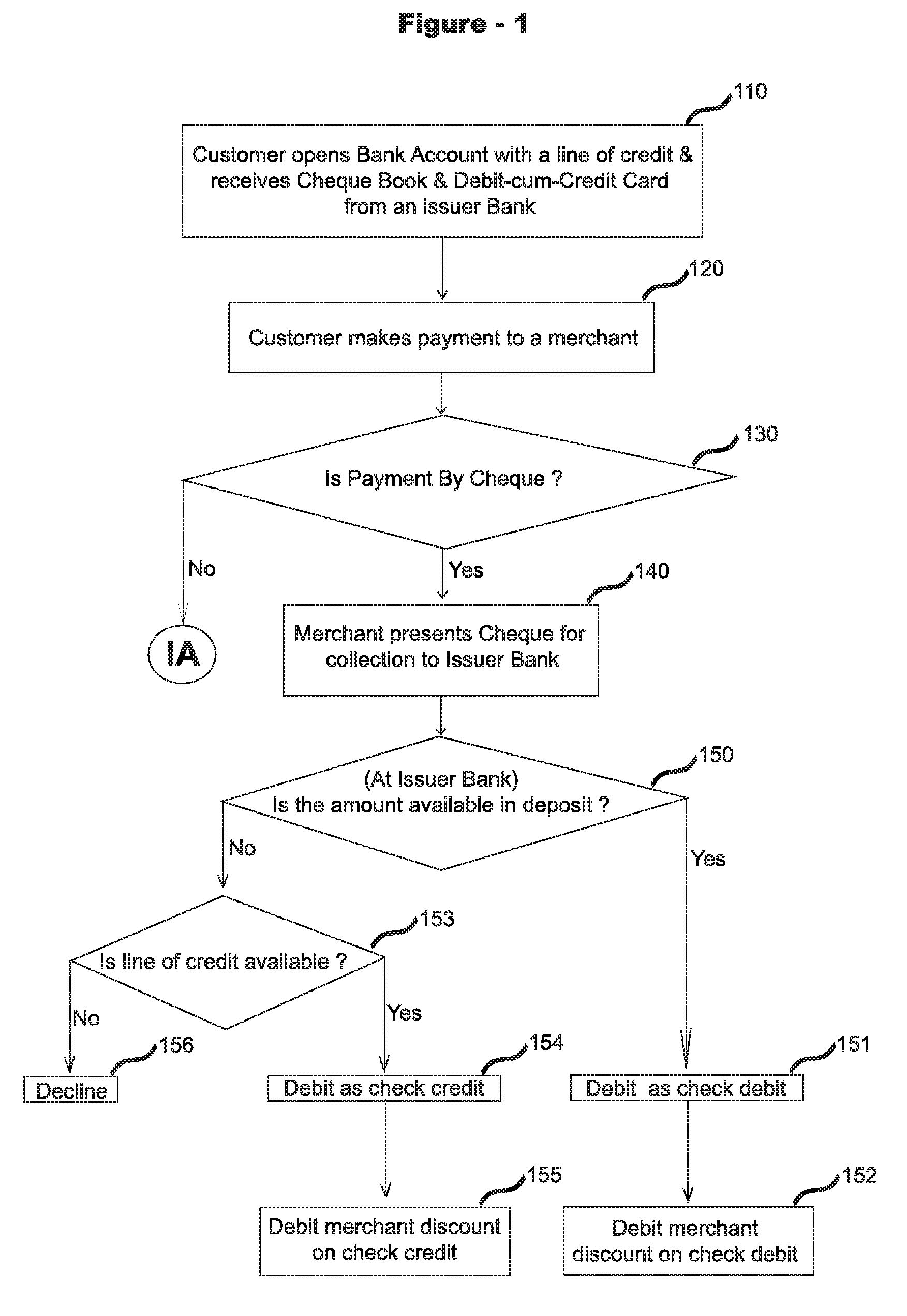

Payment system for travelers and other checks and a debit cum credit card

InactiveUS20080140579A1High feeLow costFinanceUser identity/authority verificationSubstitute checkDeposit account

A merchant discount is levied on receiving payments through Traveler's and other checks, from which a consumer reward is funded. A line of credit is extended in a conventional bank deposit account with checking option. When a check payable from such an account is presented, it is processed as a debit transaction if the funds are available from the deposits, and as a credit if it is paid from the line of credit. A debit-cum-credit card is also issued and processed through the payment system networks in the same way as above. A merchant discount is levied in each case, which may be higher in credit and lower in debit. A different level of reward incentive linked to each payment may then be awarded to the consumer, funded from the savings in processing each transaction. In addition, in a new method of check payment on the Internet, the payer writes an original check on a special form, scans and sends the scan and other check data to a payment server, which in turn produces an image replacement document to process it as a substitute check.

Owner:SANJIV AGARWAL

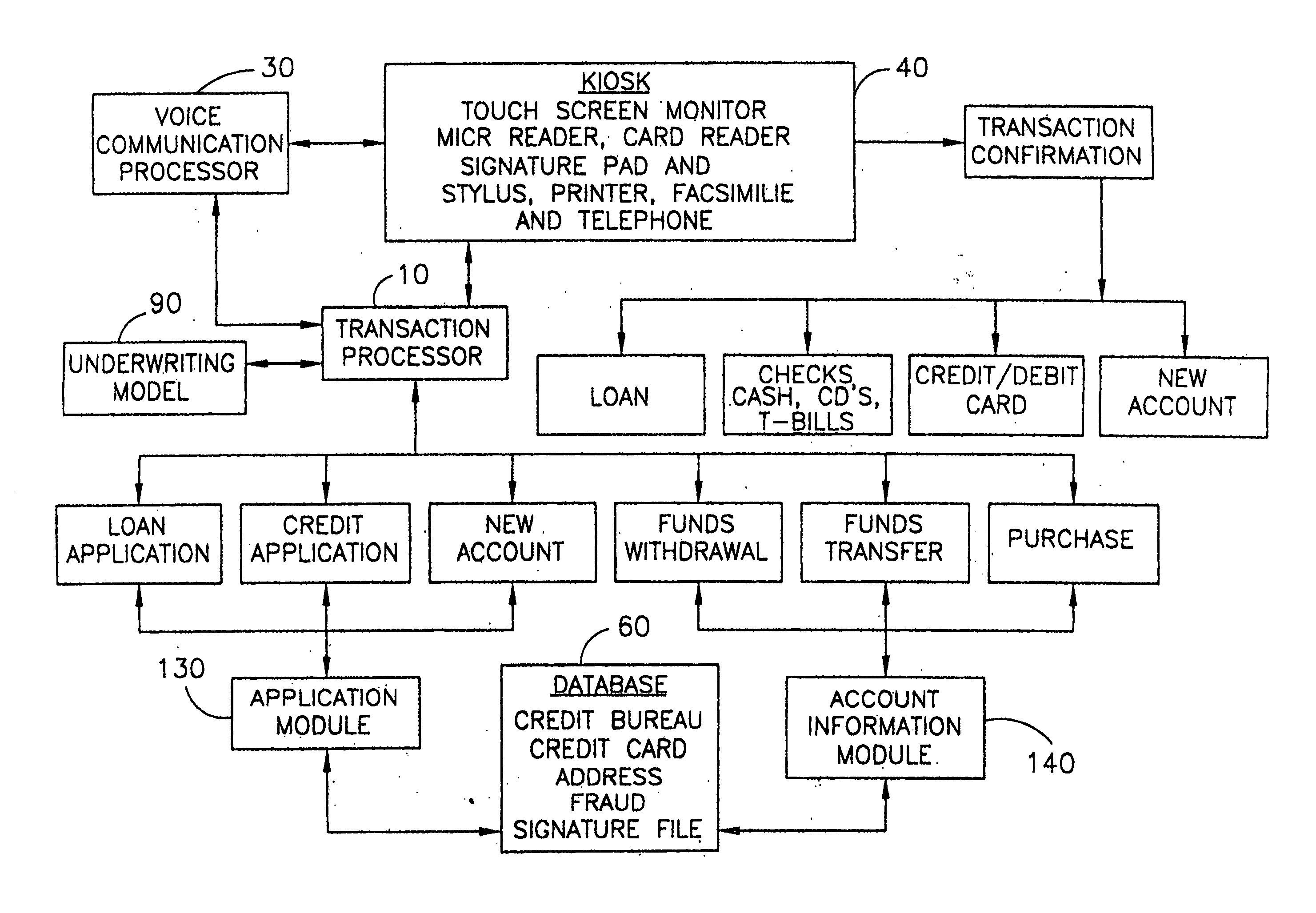

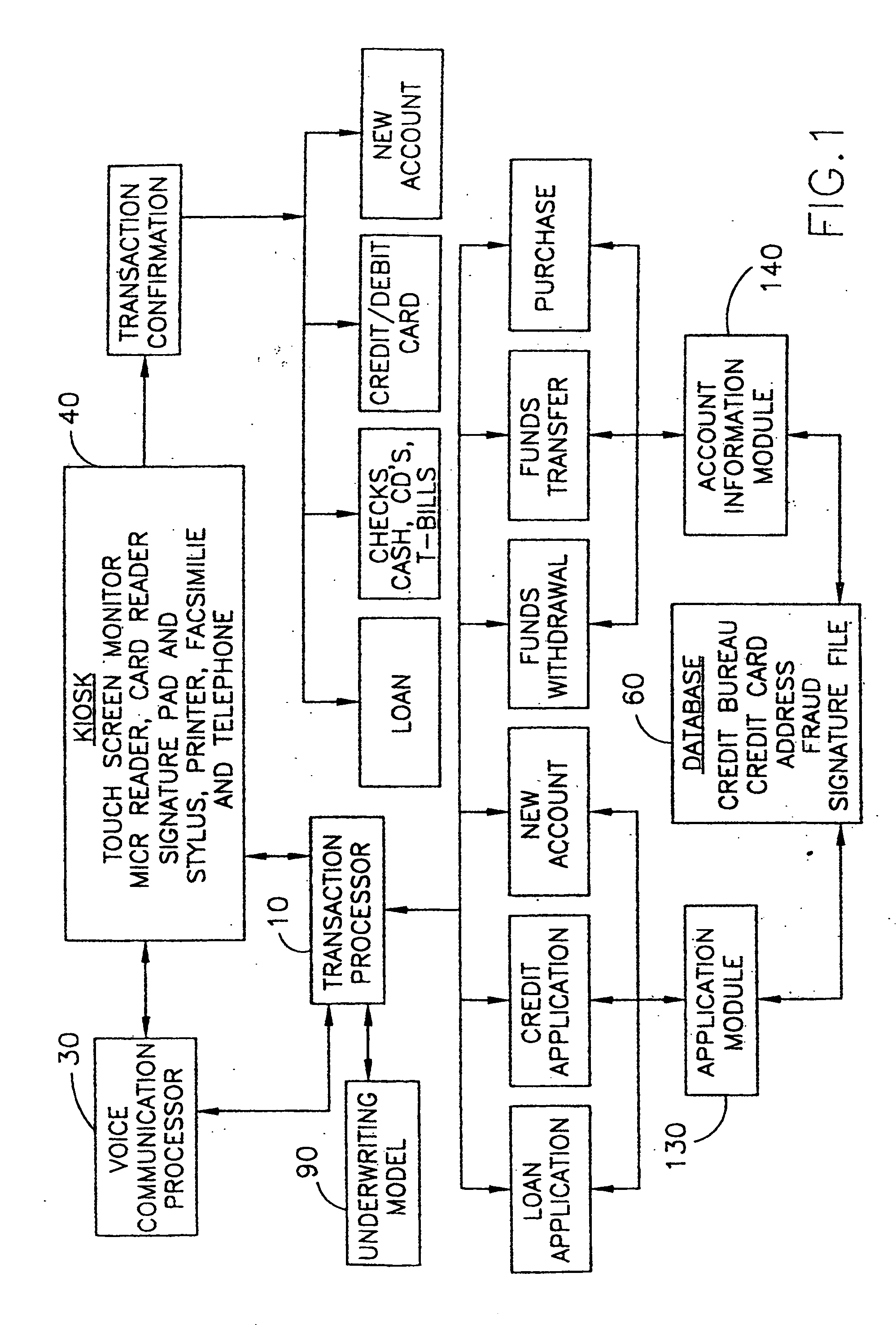

Automatic financial account processing system

InactiveUS20050038737A1Save processing timeReduce errorsComplete banking machinesFinanceDeposit accountDocumentation procedure

A method and apparatus for closed loop, automatic processing of typical financial transactions, including loans, setting up checking, savings and individual retirement accounts, obtaining cashier's checks, ordering additional checks, issuing credit and debit cards, wire transferring money, and so on. The transactions are provided from a kiosk and controlled by a computer controller interacting with the consumer. In the case of loans, a computer controller helps the consumer in the completion of the application, performs the underwriting, and transfers funds. The computer controller obtains the information needed to process the application, determines whether to approve the loan, effects electronic fund transfers to the applicant's deposit account, and arranges for automatic withdrawals to repay the loan. The computer controller reviews documentation requirements including consumer lending and other required documentation with the consumer and obtains acknowledgment of acceptance of terms by having the consumer sign an electronic signature pad. Copies of documents with a digital photograph are printed out by a printer in the kiosk for the consumer. Finally, the kiosk has the capability of imprinting a credit or debit card in response to a consumer request.

Owner:DECISIONING COM

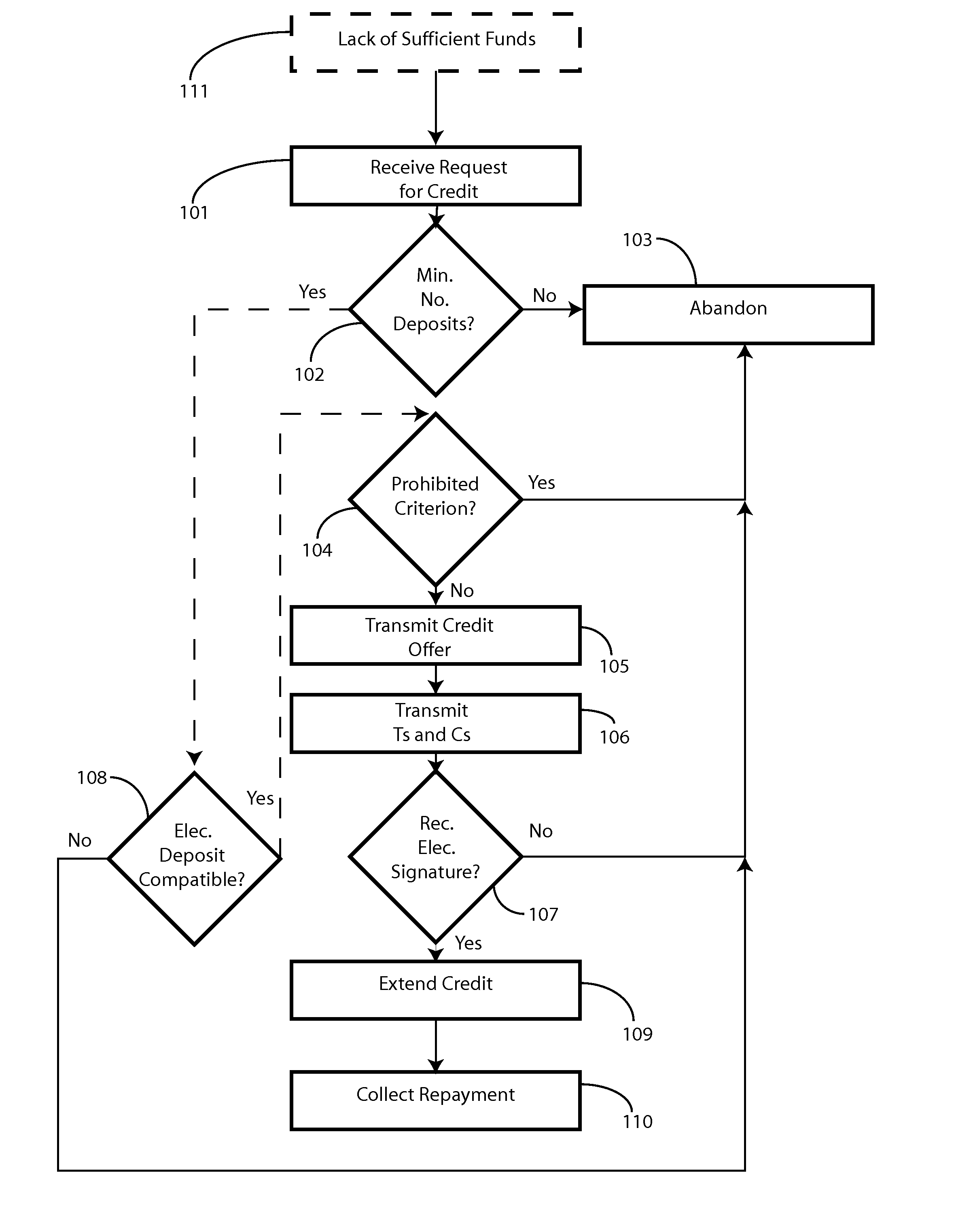

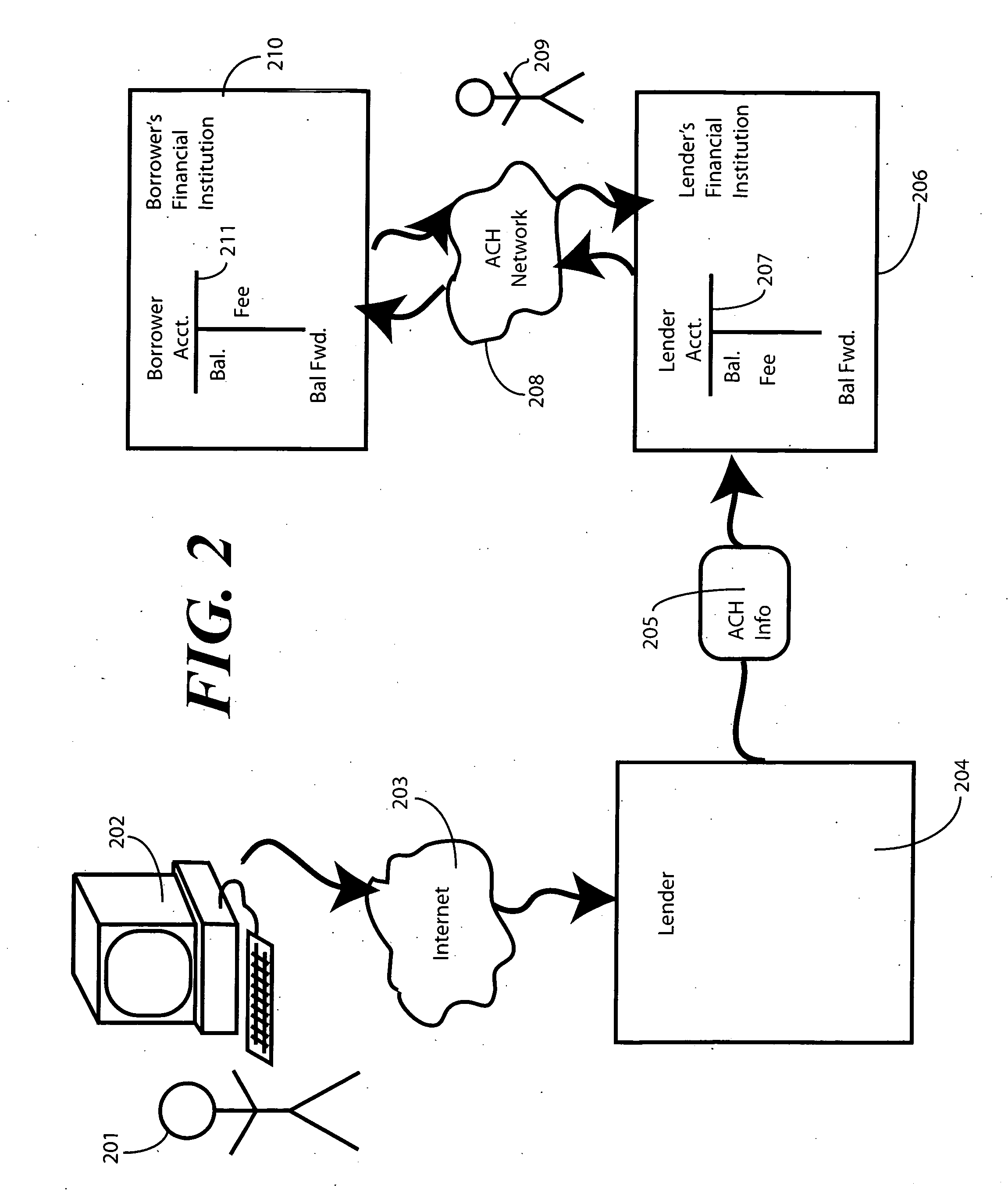

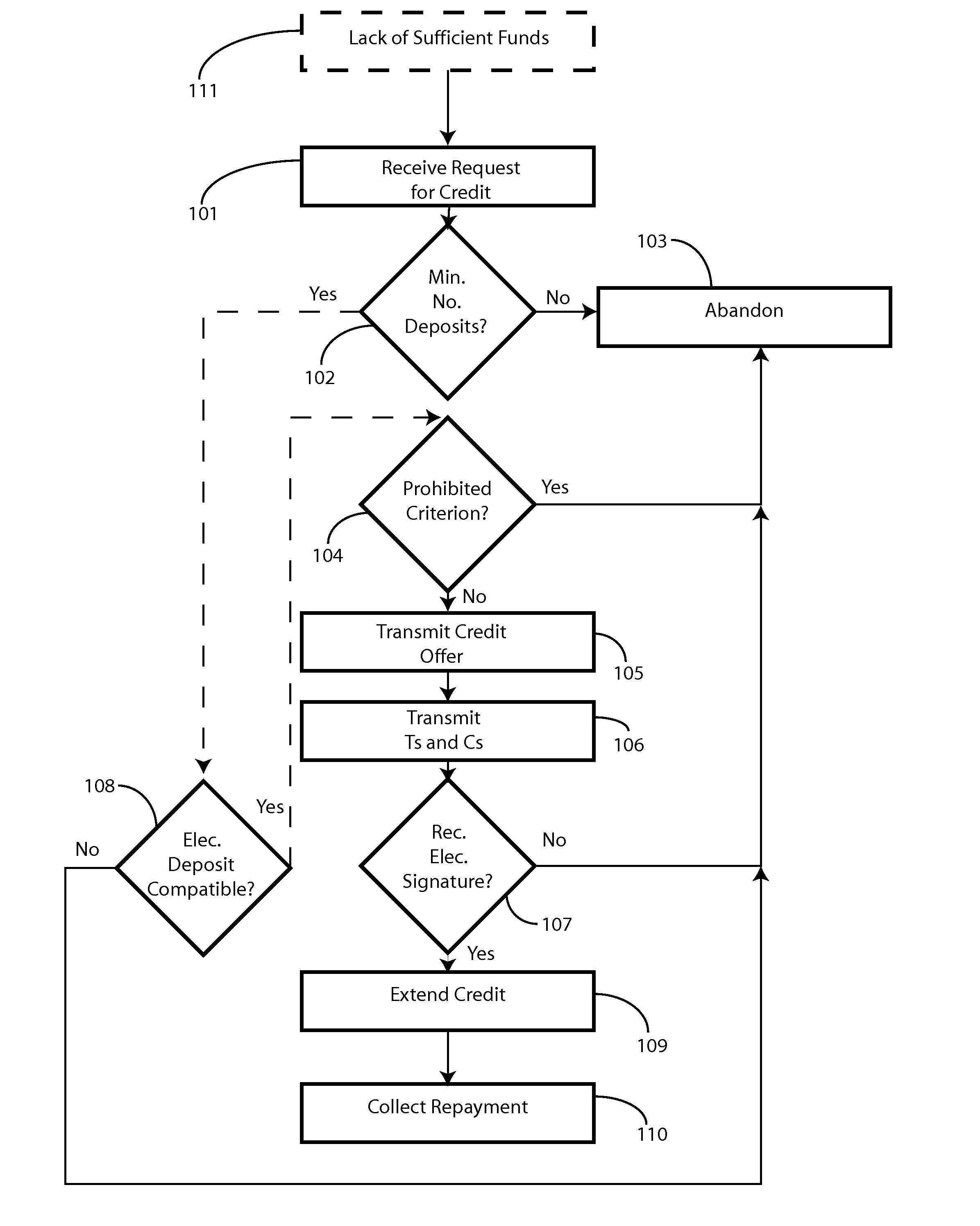

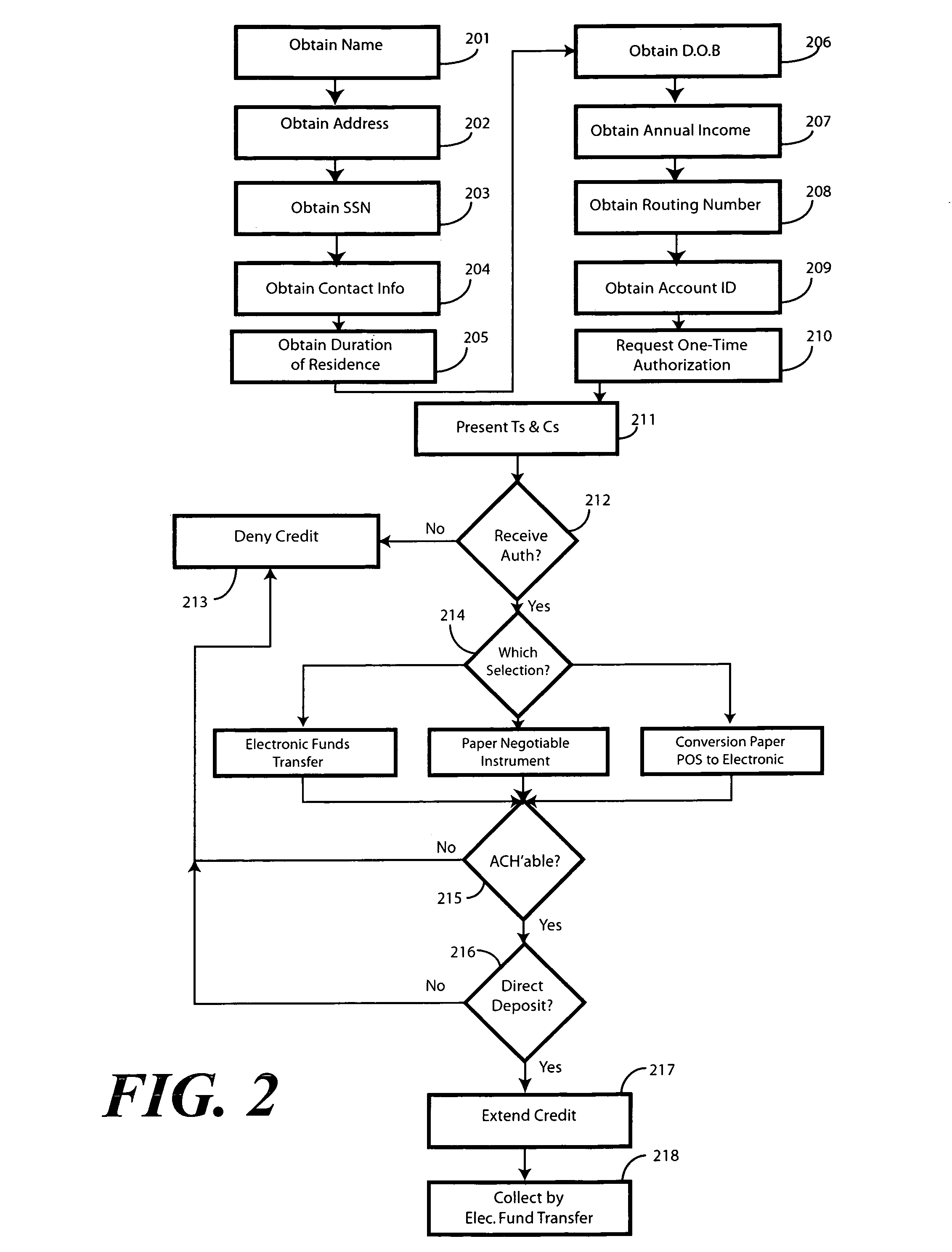

Method and System for Rapid Loan Approval

A method and apparatus for rapidly and remotely providing temporary credit to a borrower is provided. In one embodiment, a lender uses as one criterion in approving the temporary credit a minimum number of deposits within a predetermined deposit verification time. Upon receipt of a request for credit, which may come either from a prospective borrower or from a merchant upon denial of credit to the prospective borrower, a lender queries a deposit account to determine whether a predetermined minimum number of deposits has been made within a predetermined deposit verification time. The lender may also determine whether each of the deposits exceeds a minimum deposit amount. Where approved, the lender is able to rapidly dispense funds for use by the borrower. In one embodiment, the lender makes these funds available via a pre-paid credit card. The lender is then able to collect principal and interest through electronic withdrawals.

Owner:CC SERVE

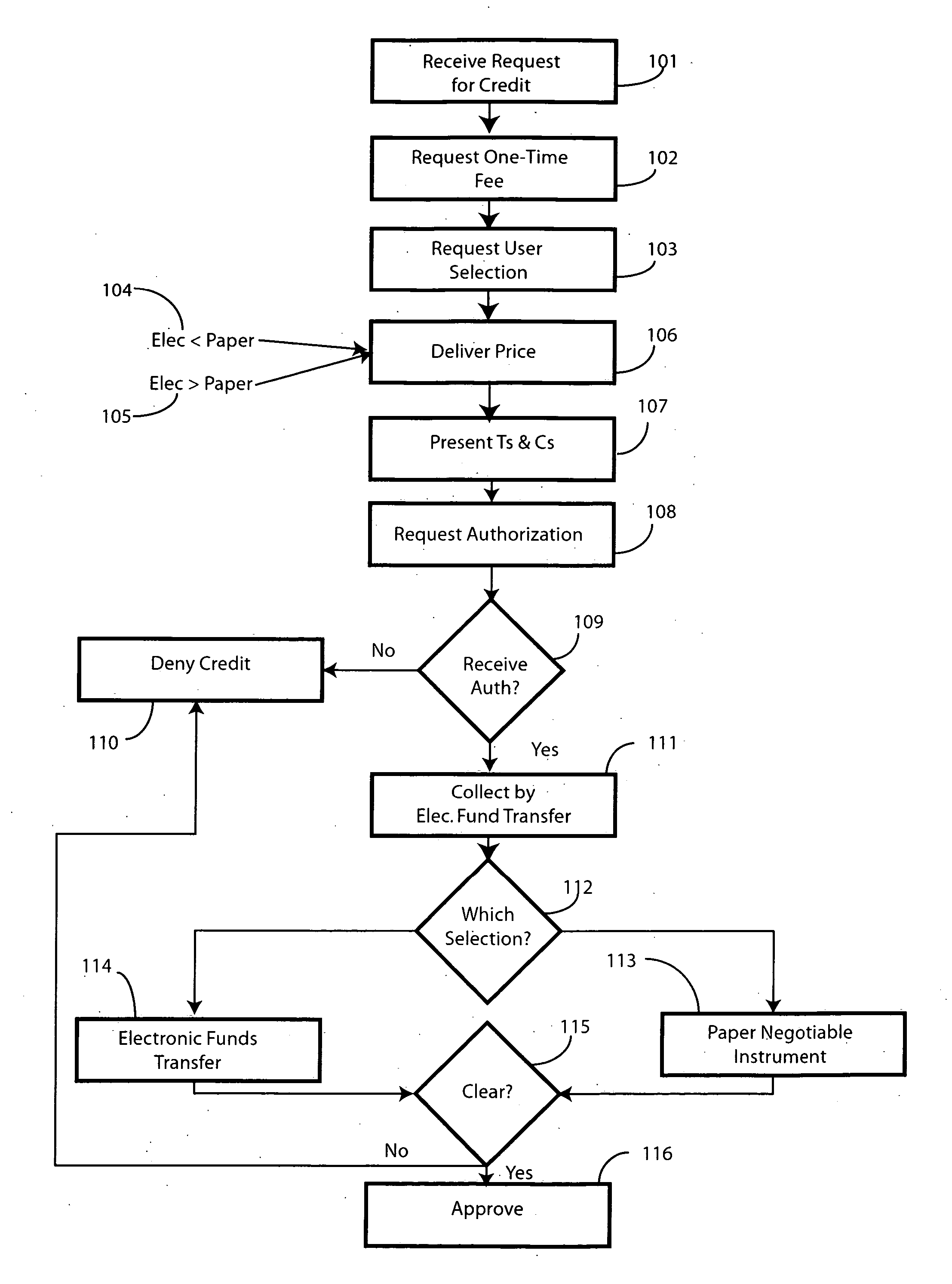

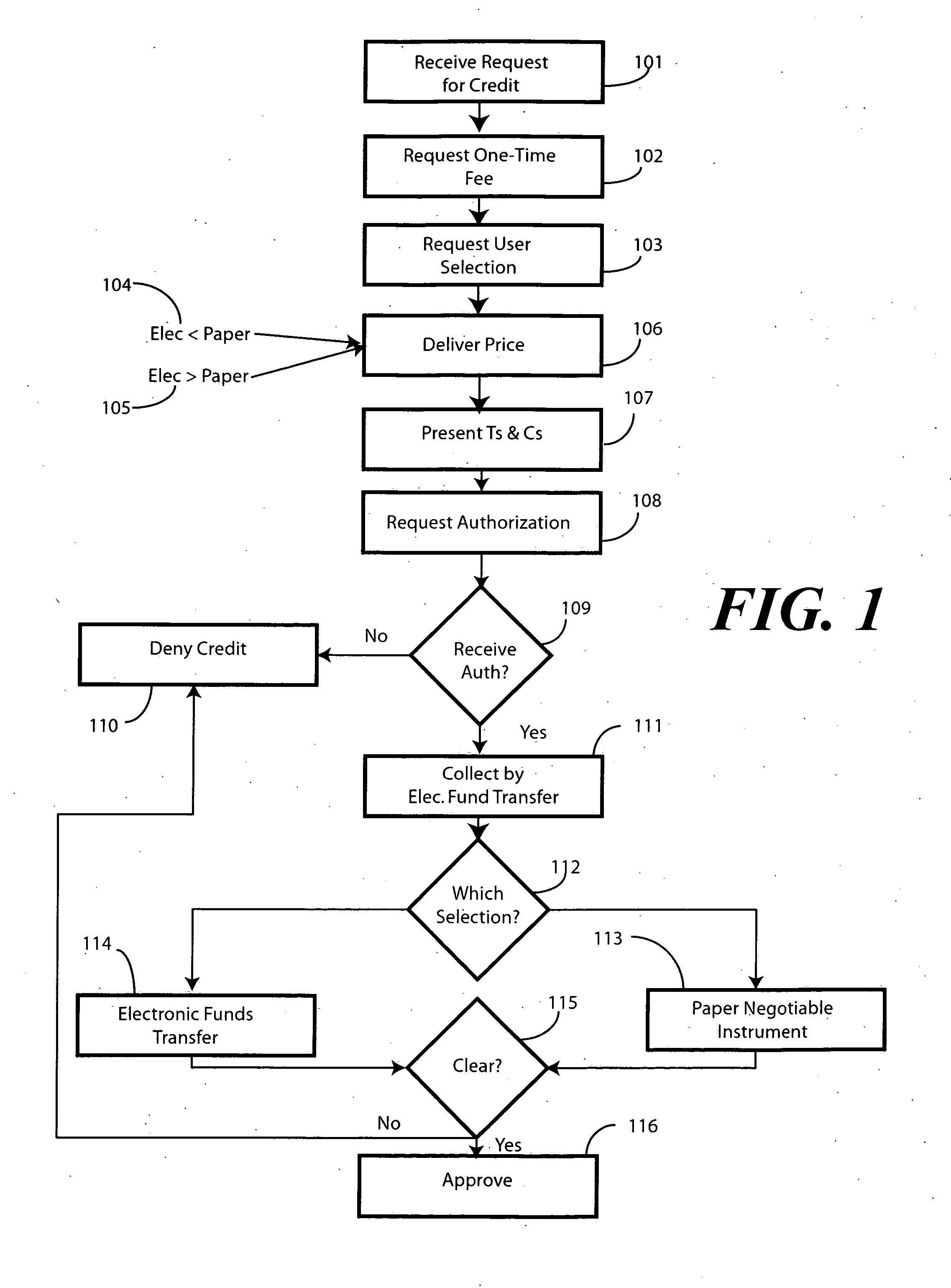

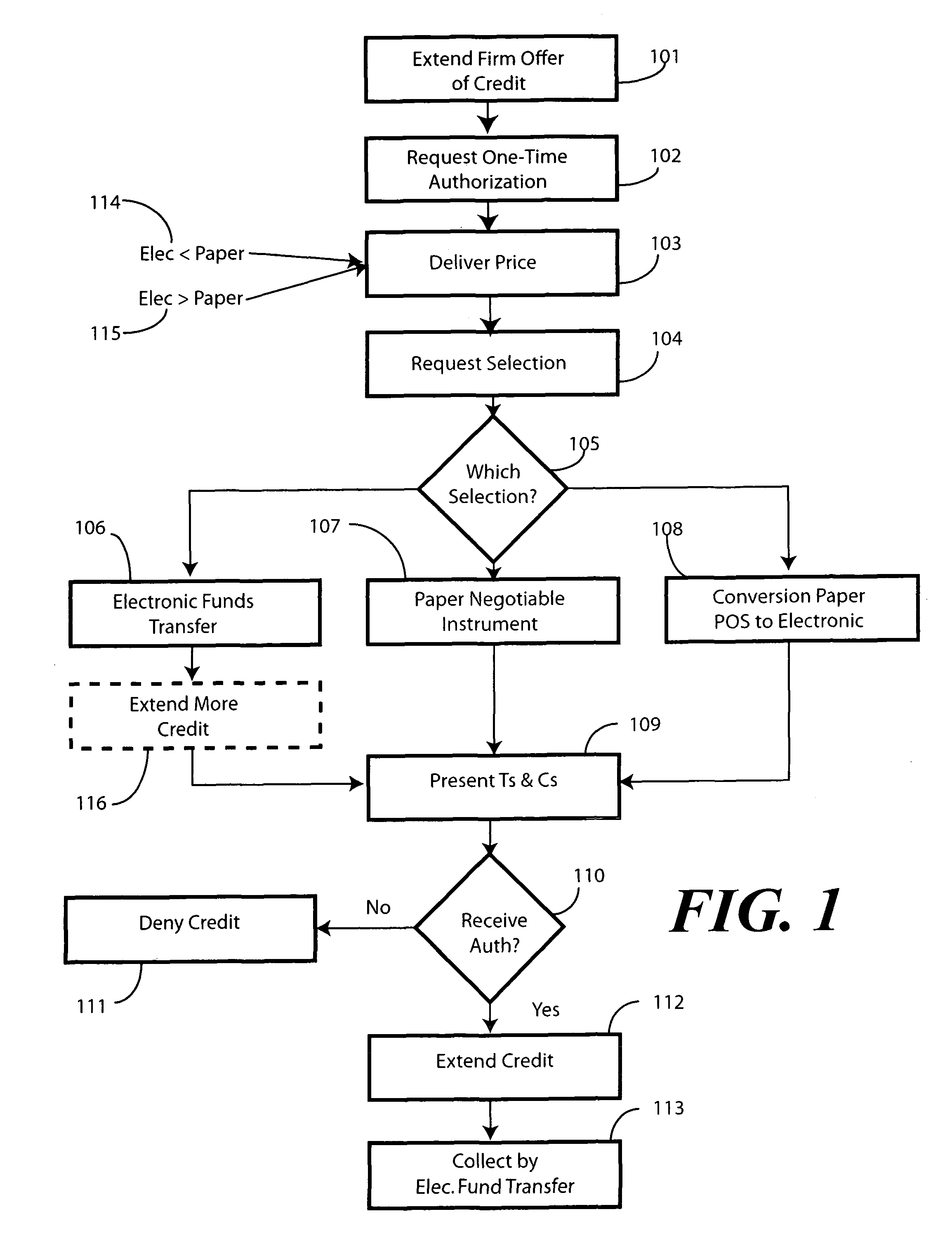

Method and system for account verification

A system and method for verifying the existence of a deposit account, such as a checking account, are provided. The system and method may also be used to determine whether the deposit account is configured to receive automatic transactions for withdrawal. For example, a lender may extend an offer of credit to a borrower where payments of principal and interest are to be made by automatic withdrawals. Prior to transferring the principal, the lender verifies the existence and configuration of the borrower's deposit account by charging a fee to establish the line of credit and retrieving the fee by automatic withdrawal. Once the transaction clears and the lender receives the fee, the lender is assured that the account does exist and is configured to receive automatic transactions. Two exemplary methods of retrieving the fee are electronic funds transfer and remote creation of a paper negotiable instrument.

Owner:CC SERVE

Method and system for rapid loan approval

A method and apparatus for rapidly and remotely providing temporary credit to a borrower is provided. In one embodiment, a lender uses as one criterion in approving the temporary credit a minimum number of deposits within a predetermined deposit verification time. Upon receipt of a request for credit, which may come either from a prospective borrower or from a merchant upon denial of credit to the prospective borrower, a lender queries a deposit account to determine whether a predetermined minimum number of deposits has been made within a predetermined deposit verification time. The lender may also determine whether each of the deposits exceeds a minimum deposit amount. Where approved, the lender is able to rapidly dispense funds for use by the borrower. In one embodiment, the lender makes these funds available via a pre-paid credit card. The lender is then able to collect principal and interest through electronic withdrawals.

Owner:CC SERVE

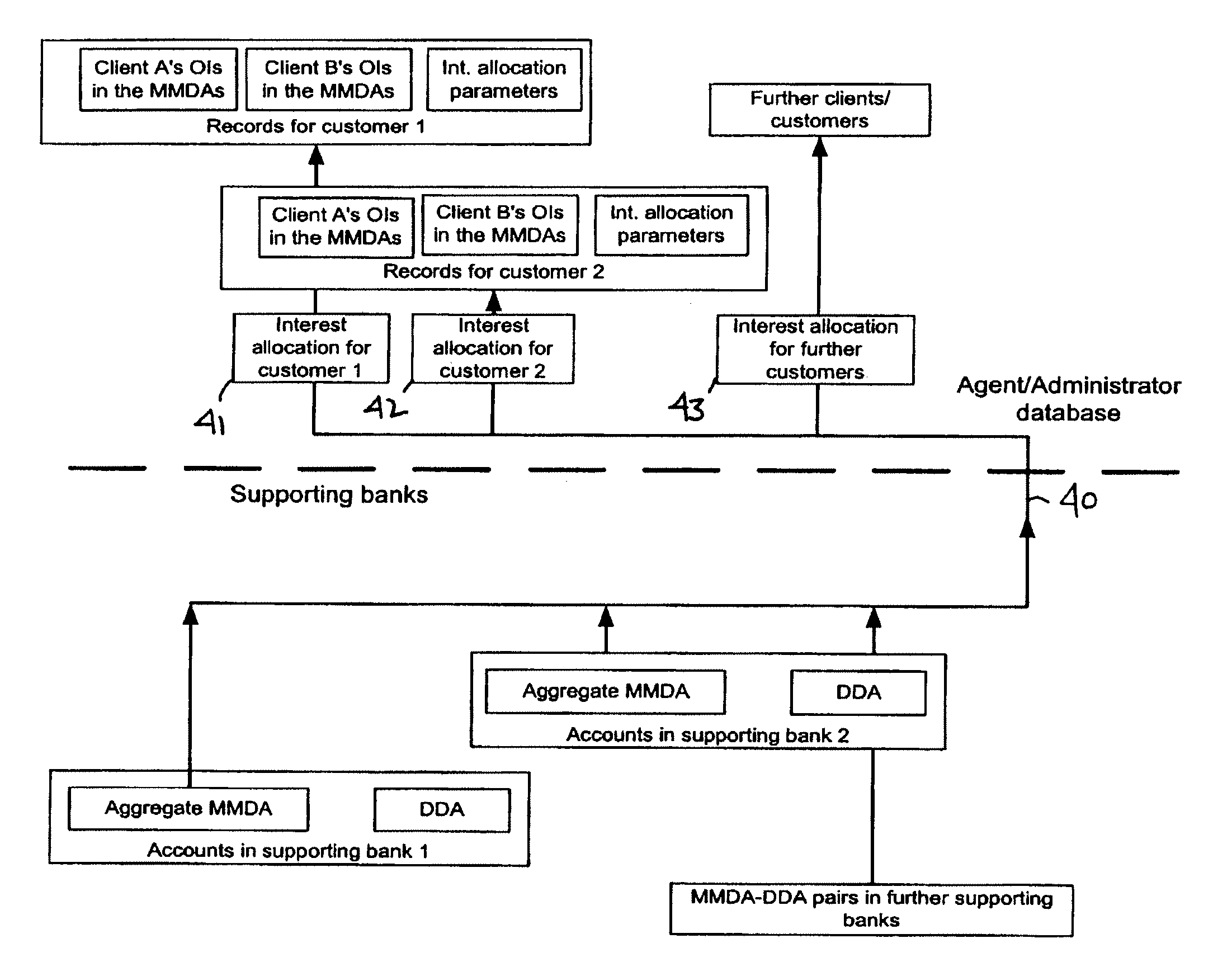

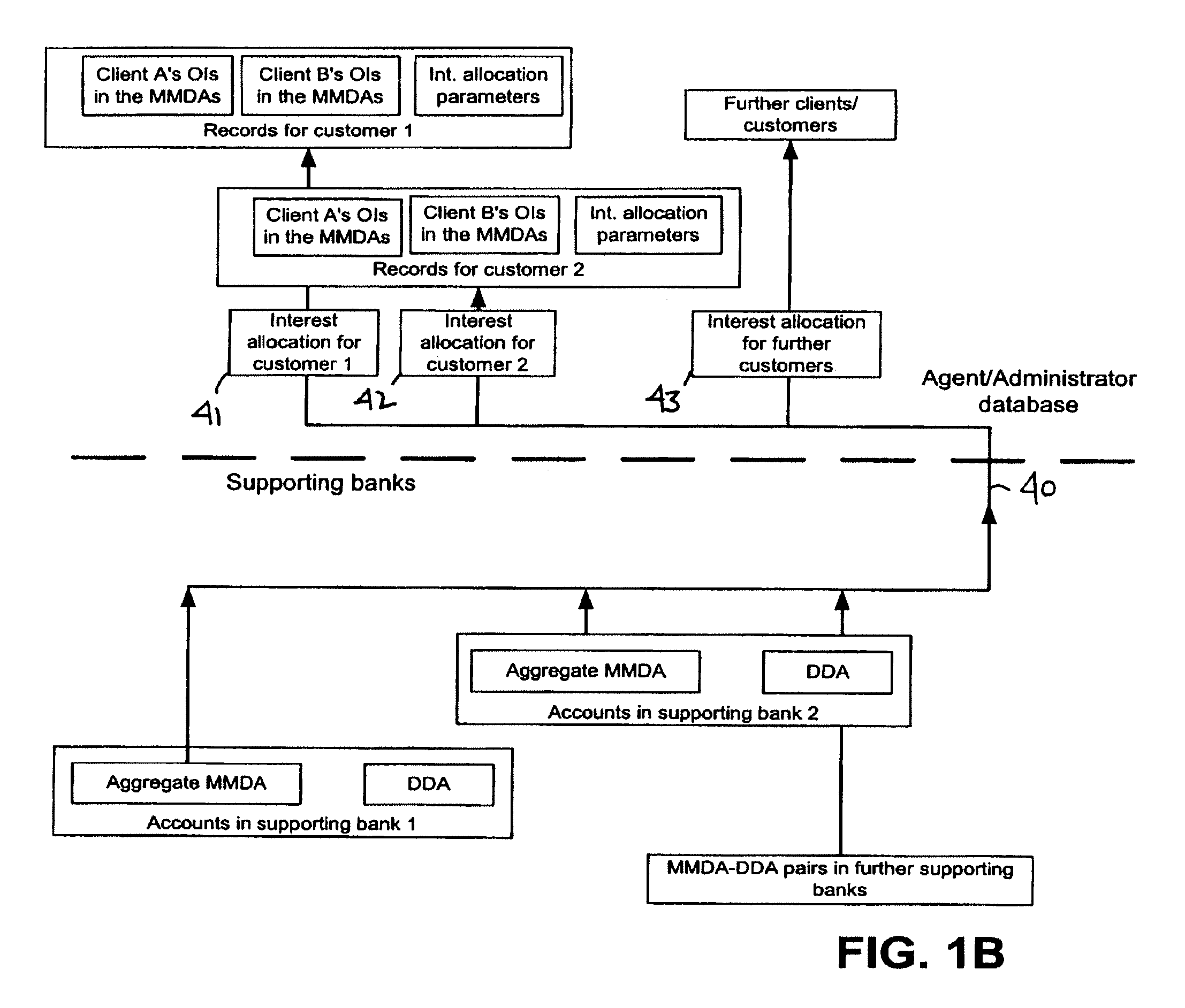

Systems and methods for money fund banking with flexible interest allocation

InactiveUS7668772B1Remove restrictionsFlexible controlFinancePayment architectureDeposit accountDatabase

This invention provides system and methods for managing accounts of clients at customer financial entities so that deposits of up to $100,000 or greater are insured, so that interest income earned on a portion of all of the account balances may be flexibly allocated according to customer instructions, and so that withdrawals are not limited. These objects are satisfied by holding client funds at interest-earning money market deposit accounts at one or more banks or savings institutions. More particularly, this invention provides methods for receiving client transaction information, determining a net transfer of funds into or out of each client account from transaction information, causing transfer of funds from the insured, interest-bearing deposit accounts to match the net transfer of funds into or out of each client account, and allocating interest earned by the deposit accounts to clients according to customer instructions. This invention also provides systems and software products implementing these methods.

Owner:ISLAND INTPROP

Method and system for extending credit with automated repayment

A system and method for extending a firm offer of credit contingent upon receiving a one-time authorization to execute recurring automatic withdrawals from a deposit account is provided. In providing the one-time authorization to execute recurring automatic withdrawals, a prospective borrower may elect from a plurality of automatic withdrawal repayment options. One such option is electronic fund transfer, such as the initiation of a withdrawal entry into the Automated Clearing House network. A second option is by the remote creation of a paper negotiable instrument, which is then converted into an electronic substitute check capable of electronic routing. Upon receiving the one-time authorization, the lender may make recurring automatic withdrawals from the borrower's deposit account.

Owner:CC SERVE

Technique for account authentication

InactiveUS7177846B2Convenient registrationCost efficientFinanceComputer security arrangementsDeposit accountDatabase

A technique for confirming an association between a deposit account and an account holder is provided. The technique includes receiving information identifying the deposit account and identifying the account holder. Other information associated with multiple deposit accounts, each maintained at one of multiple financial institutions, is accessed. The received information and the accessed information are then processed to authenticate the association between the account holder and the deposit account.

Owner:CHECKFREE SERVIES CORP

Transfer account systems, computer program products, and computer-implemented methods to prioritize payments from preselected bank account

ActiveUS8108272B2Reduce riskImprove usabilityComplete banking machinesFinanceDeposit accountBank account

Owner:PATHWARD NAT ASSOC

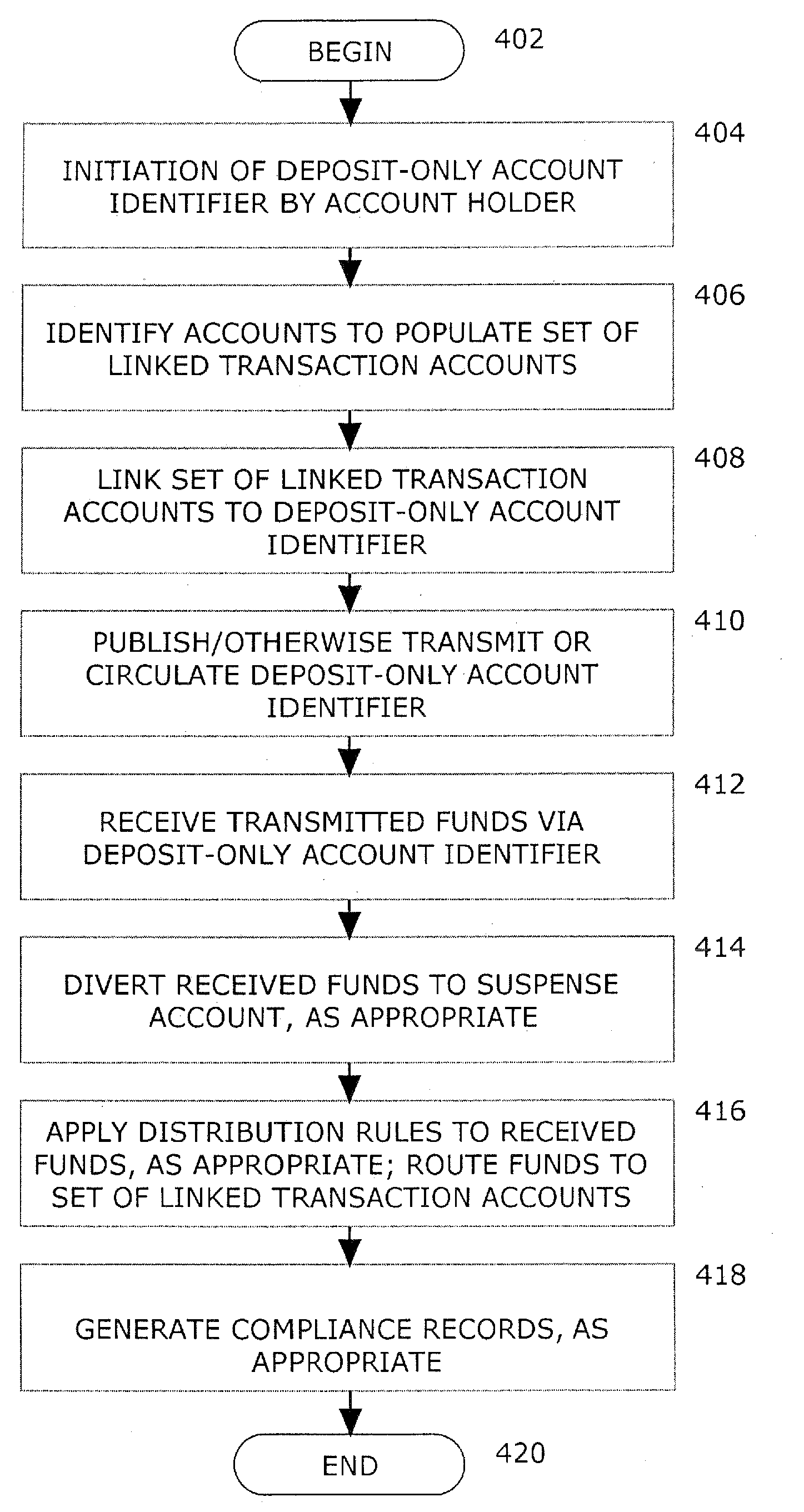

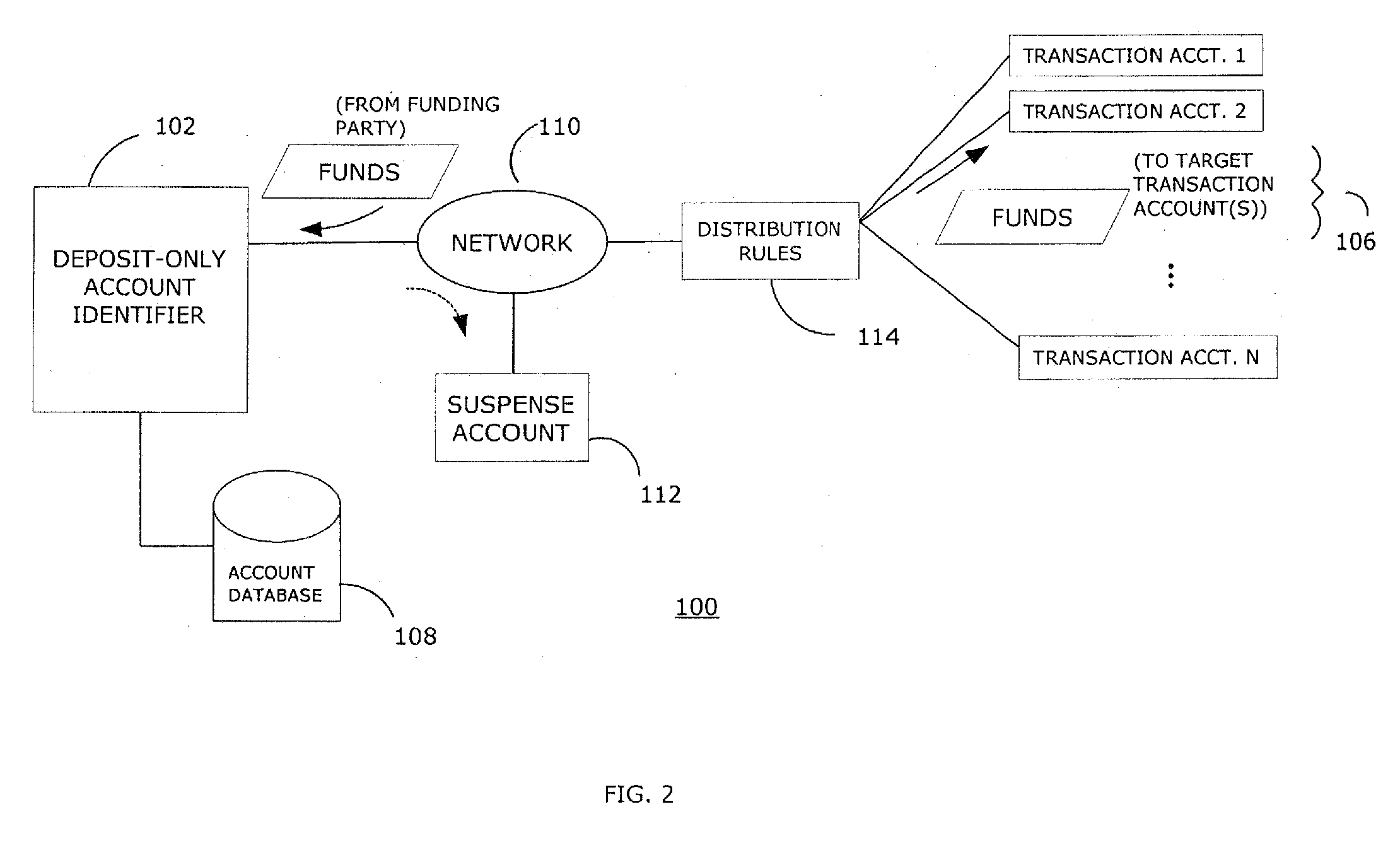

Systems and methods for generating and managing a linked deposit-only account identifier

Embodiments relate to systems and methods for generating and managing a deposit-only account identifier that can be portably linked to one or more transaction accounts, at the account holder's discretion. A deposit-only account identifier can be a virtual identifier, such as a temporary or permanent account number. The account holder can publish the virtual identifier to desired persons, financial institutions, or other parties to permit those entities to transmit funds to the deposit-only account. The account holder can move received funds to one or more linked transaction accounts, such as bank checking accounts, money market accounts, or others. Details regarding the underlying account(s) such as geographic location, currency, balances or other information can be retained in confidence, visible only to the account holder. Received funds can be distributed to underlying accounts according to criteria such as the currency or amount of the received funds, time of receipt, or other rules.

Owner:SGL NETWORK

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com