Automatic financial account processing system

a financial account and automatic processing technology, applied in the field of closed loop financial transactions, can solve the problems of a large number of services that can only be provided to consumers, financial needs are sometimes not foreseen, and the normal working hours are still chores, so as to reduce errors, avoid human intervention, and save processing time

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

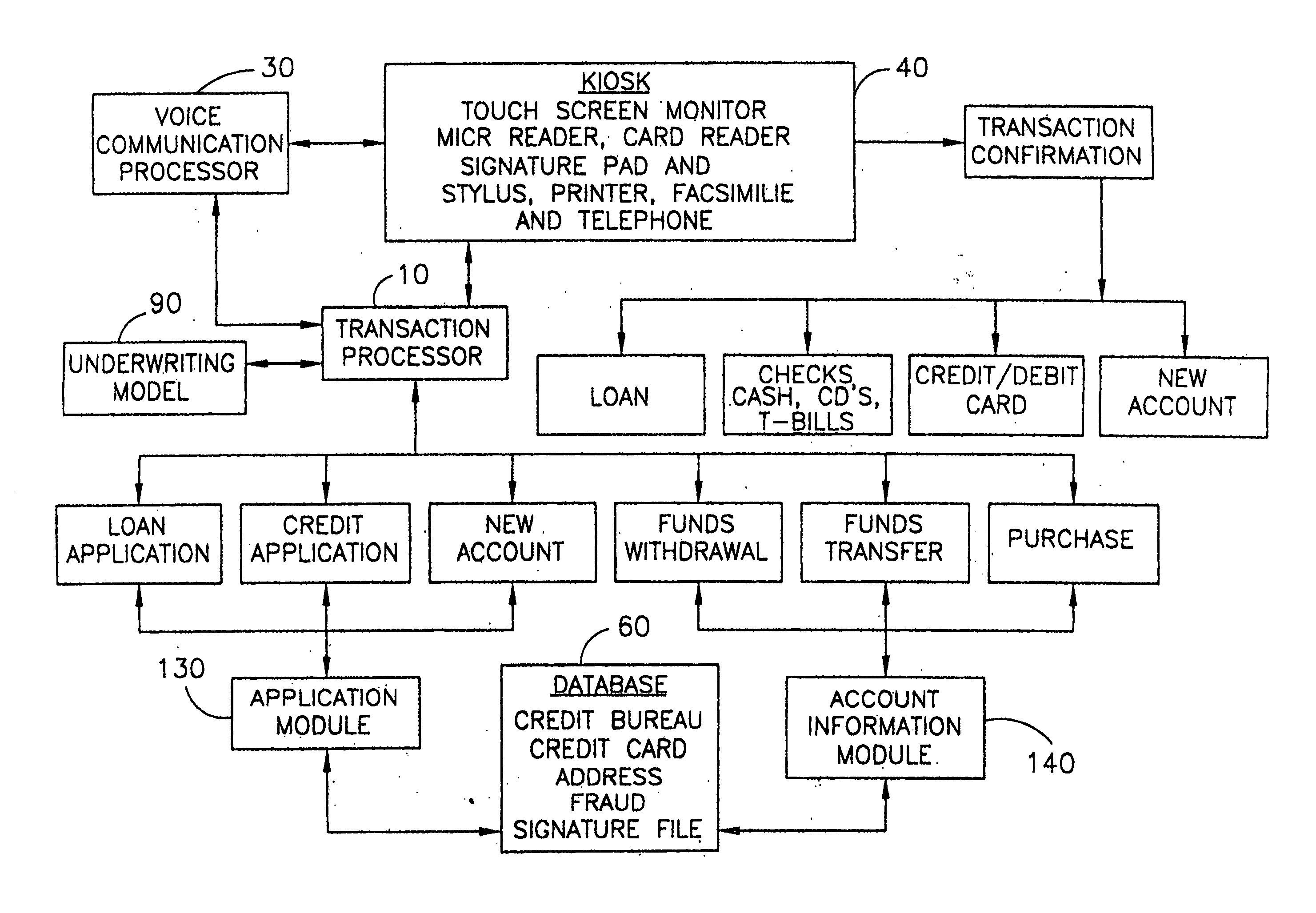

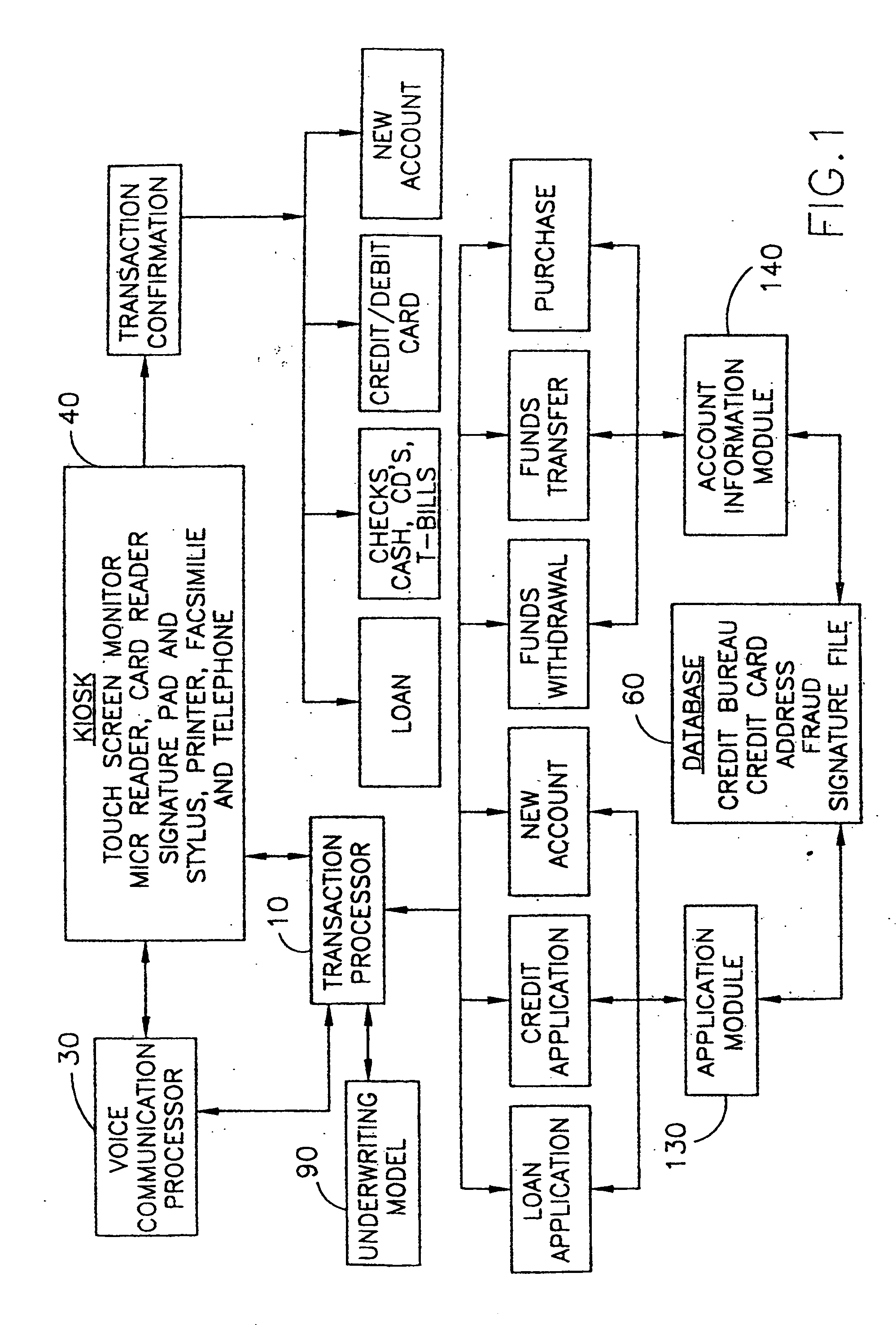

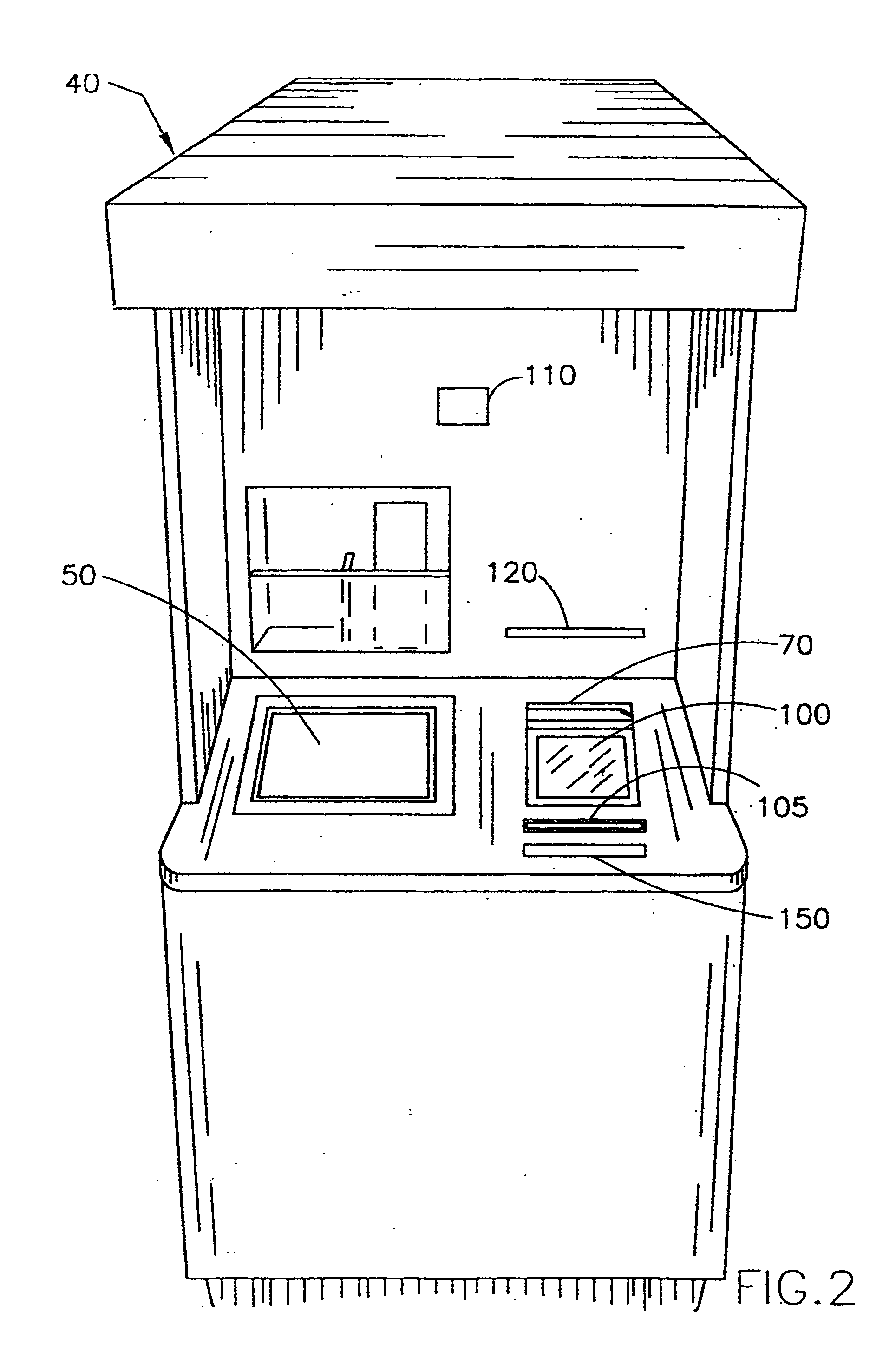

[0029] The present invention is a method and apparatus for providing closed loop financial services. In a preferred embodiment, these services include those identified in FIG. 1: specifically, making loans, issuing checks (such as cashiers' checks) certificates of deposit, treasury bills, mutual fund shares, issuing transaction cards, such as credit / debit cards and so-called “smart” cards, and establishing new accounts and depositing funds. The particular examples of loans and credit cards will be described in detail. However, the other services, as will be described presently, can also be obtained in accordance with a preferred embodiment of the present invention.

[0030] The present invention includes making a loan or obtaining a transaction card automatically, that is, a closed loop financial transaction. By the term “automatically,” it is meant that an application is received and processed, the decision to grant the loan or to issue the credit card, and the deposit of the loaned ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com