Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

2250 results about "Mobile payment" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Mobile payment (also referred to as mobile money, mobile money transfer, and mobile wallet) generally refer to payment services operated under financial regulation and performed from or via a mobile device. Instead of paying with cash, cheque, or credit cards, a consumer can use a mobile to pay for a wide range of services and digital or hard goods. Although the concept of using non-coin-based currency systems has a long history, it is only in the 21st century that the technology to support such systems has become widely available.

Mobile Person-to-Person Payment System

InactiveUS20070255653A1Easy to useFraudulent transaction is minimizedFinancePayment architectureBarcodeFinancial transaction

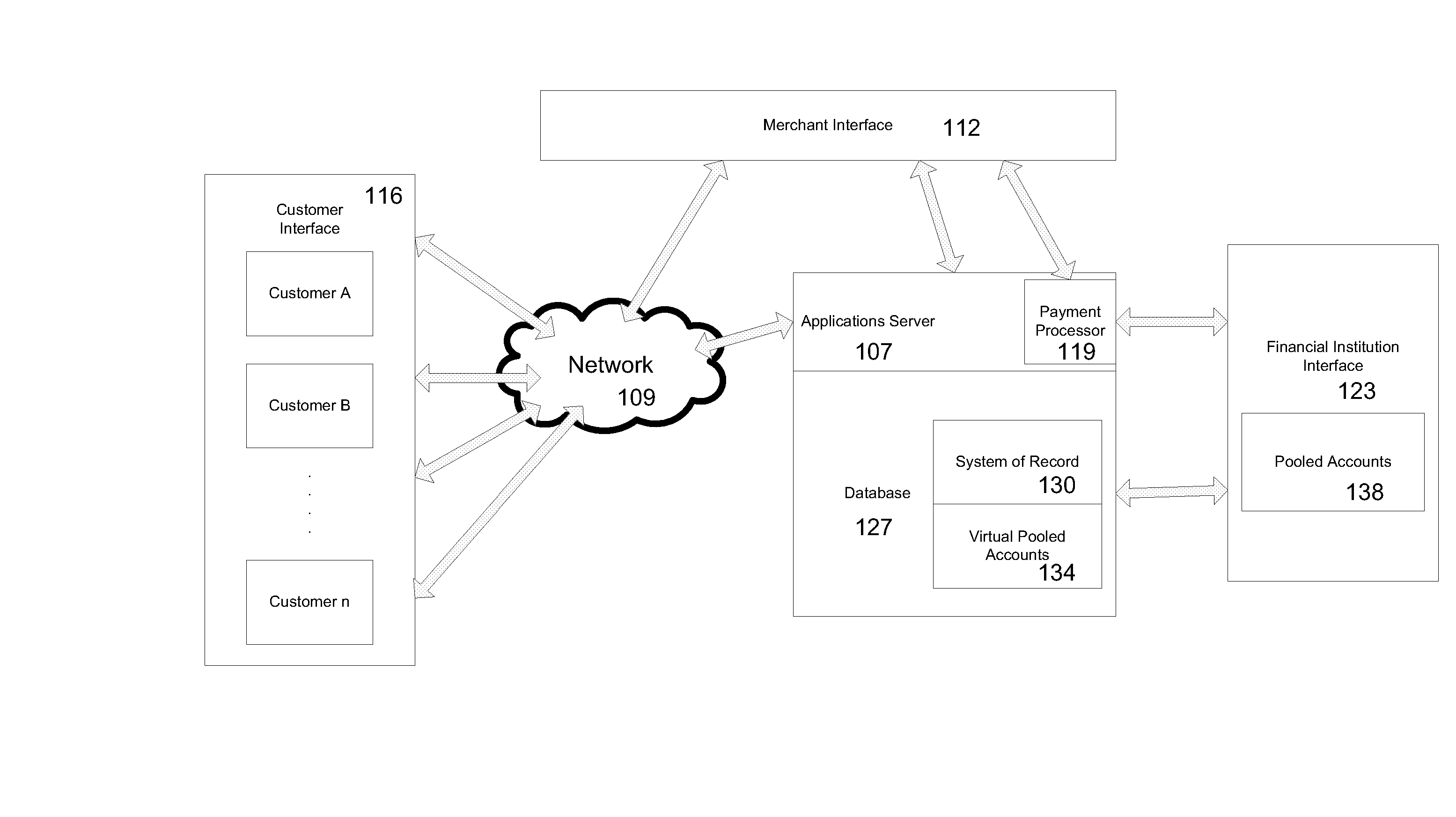

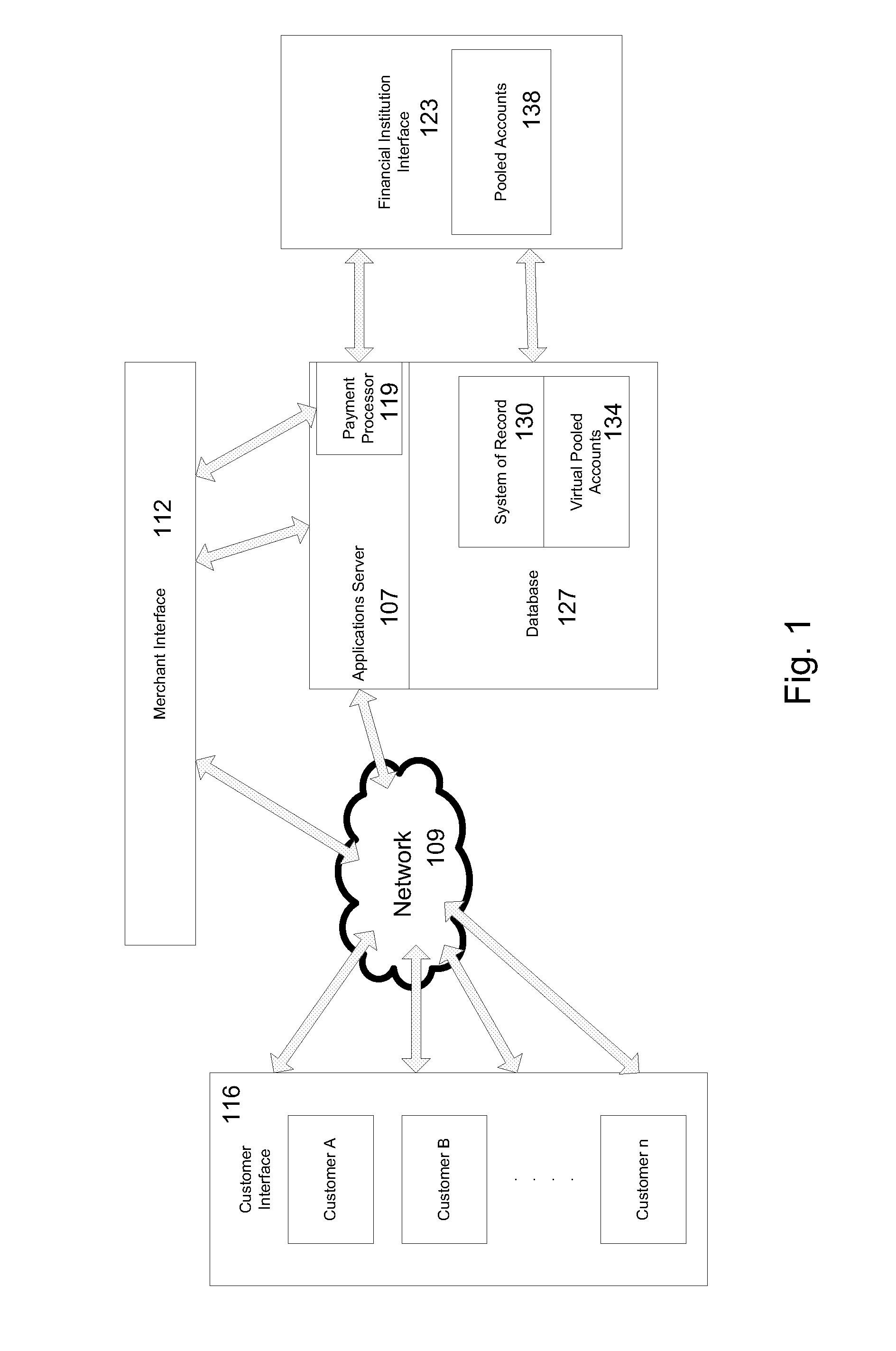

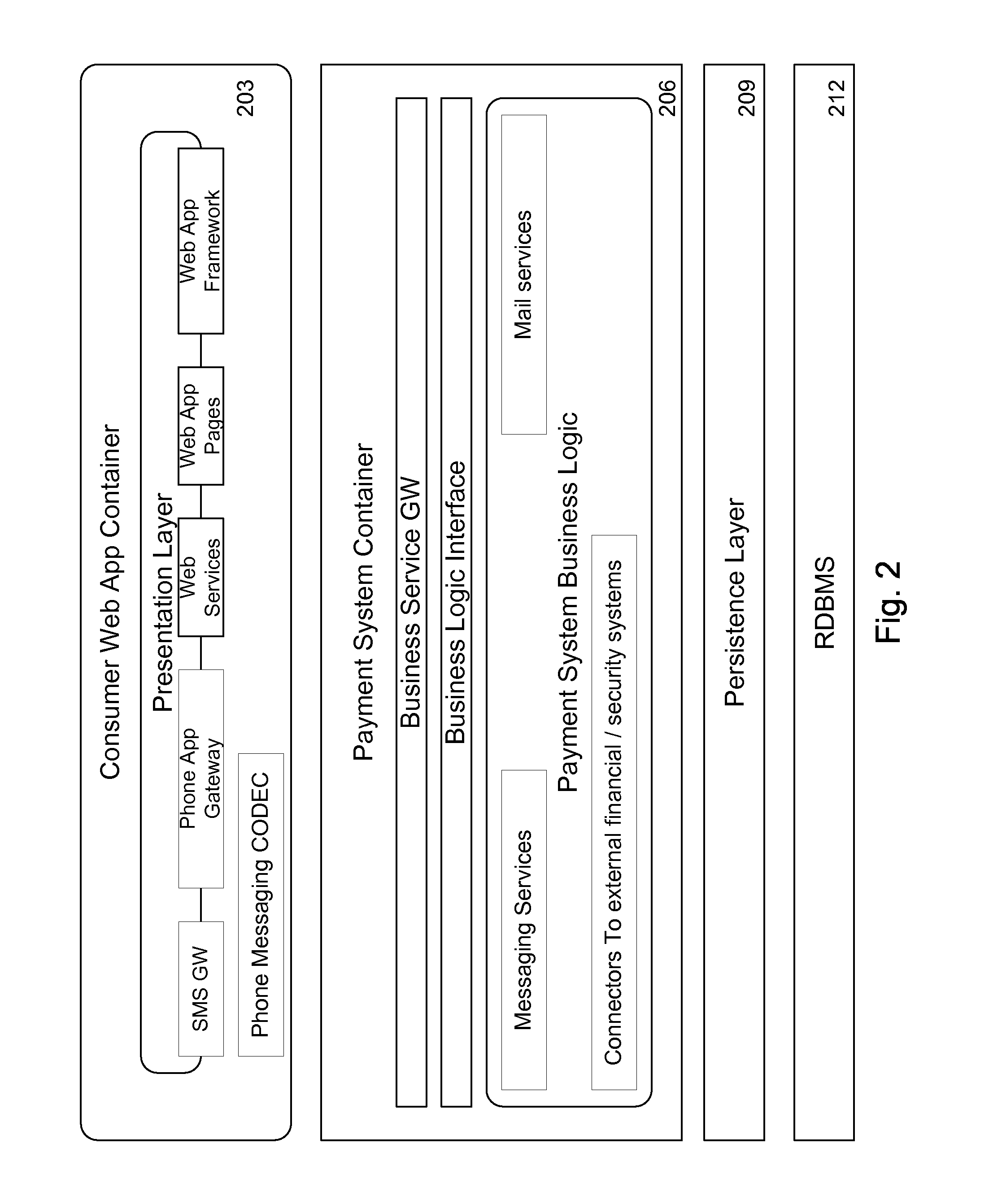

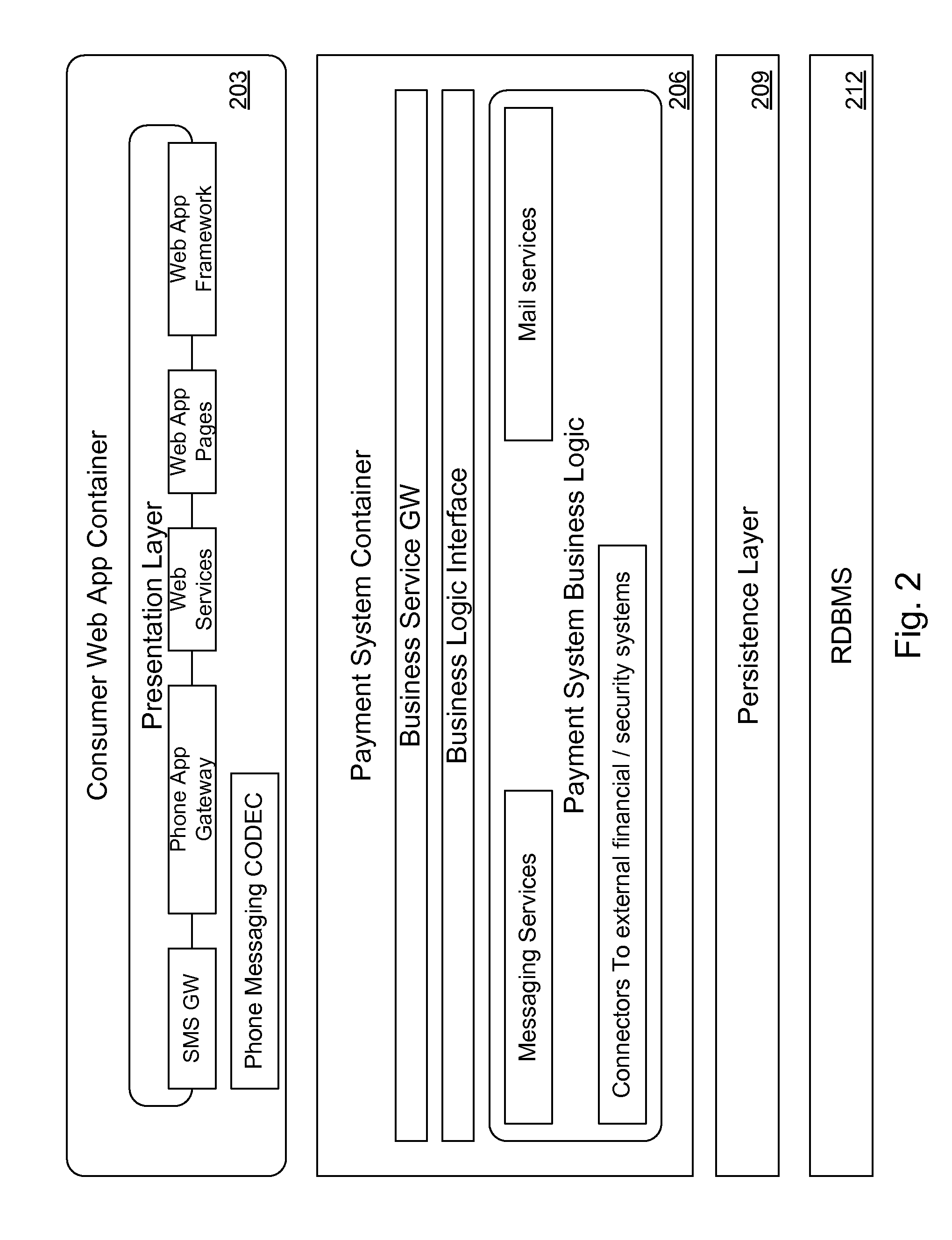

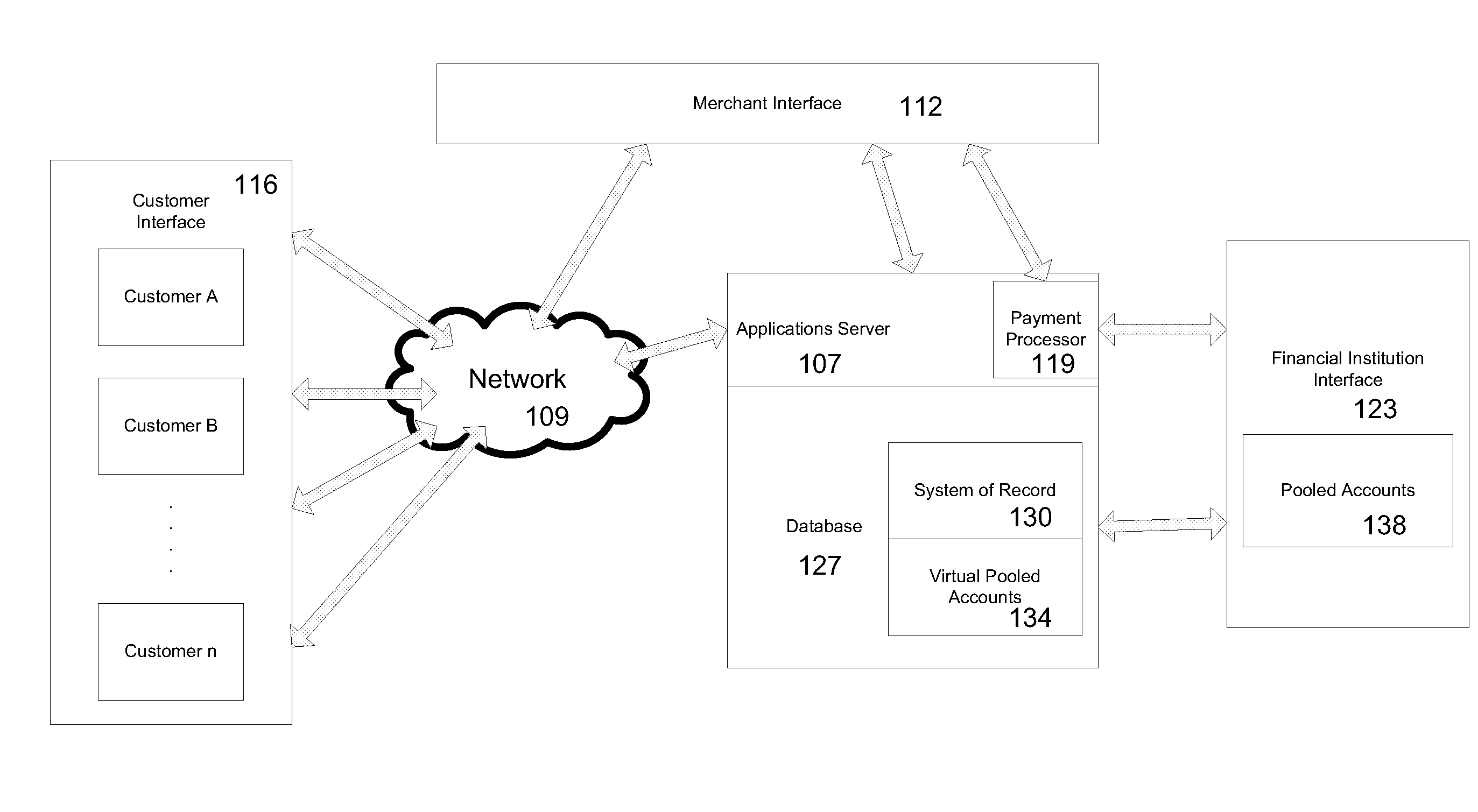

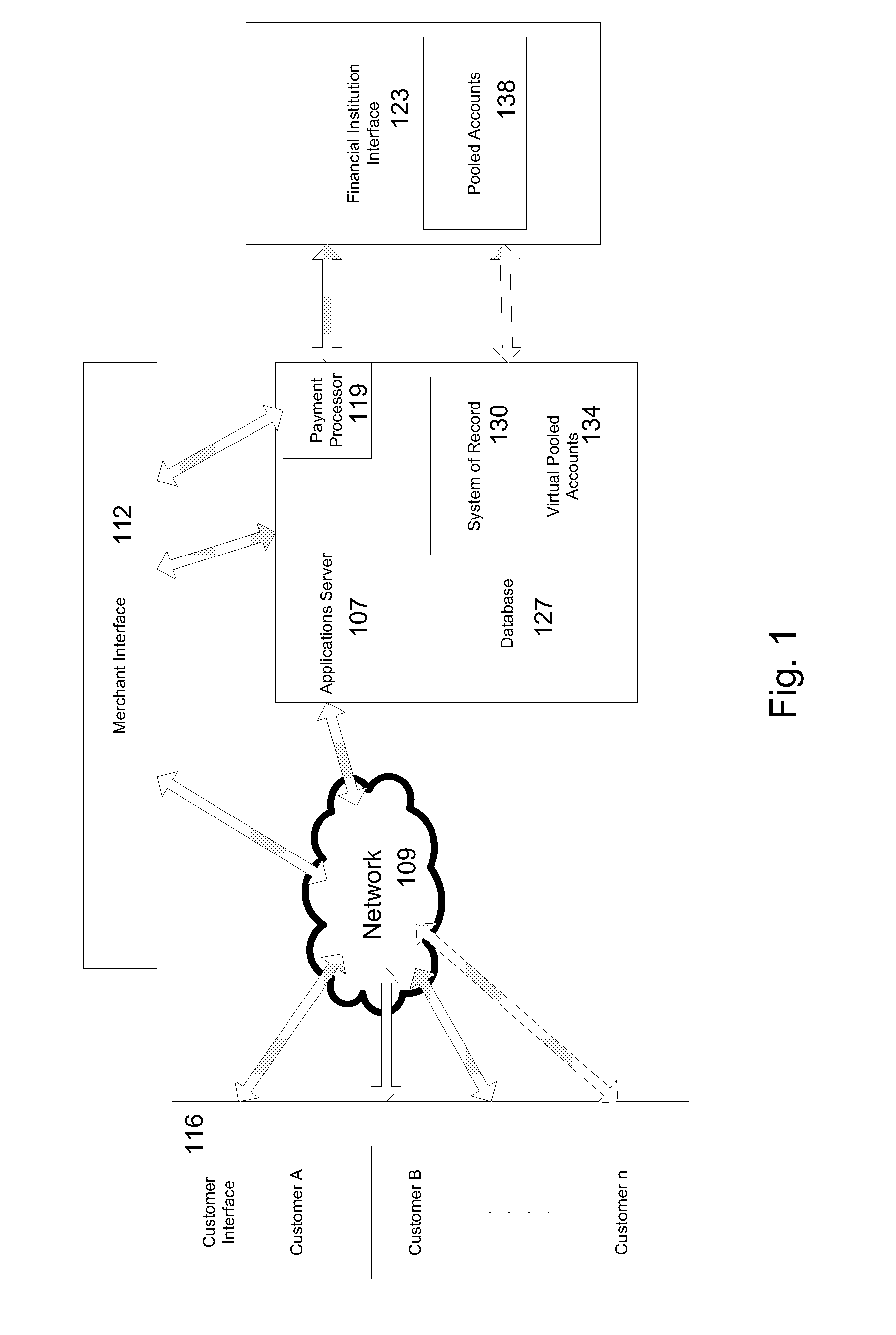

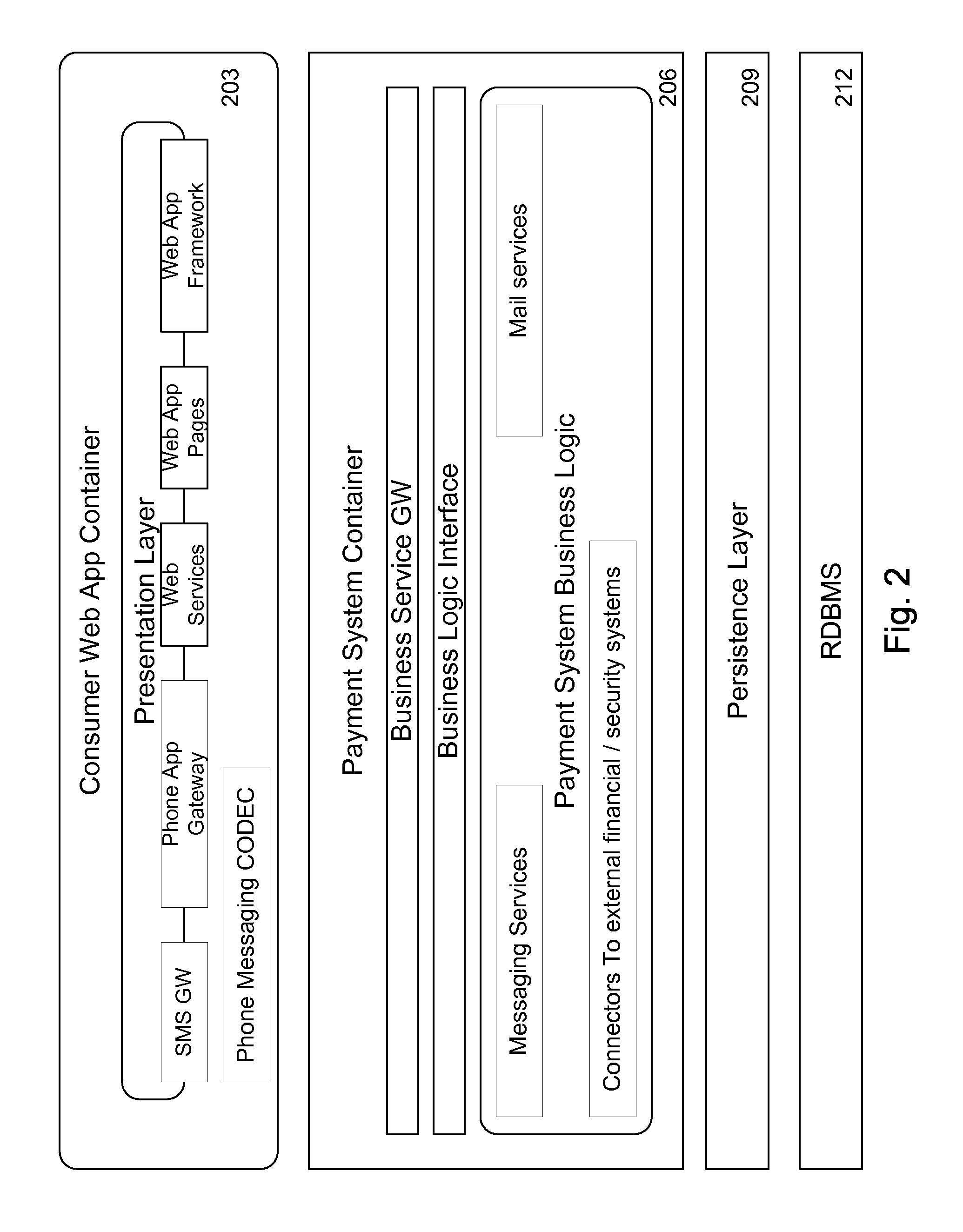

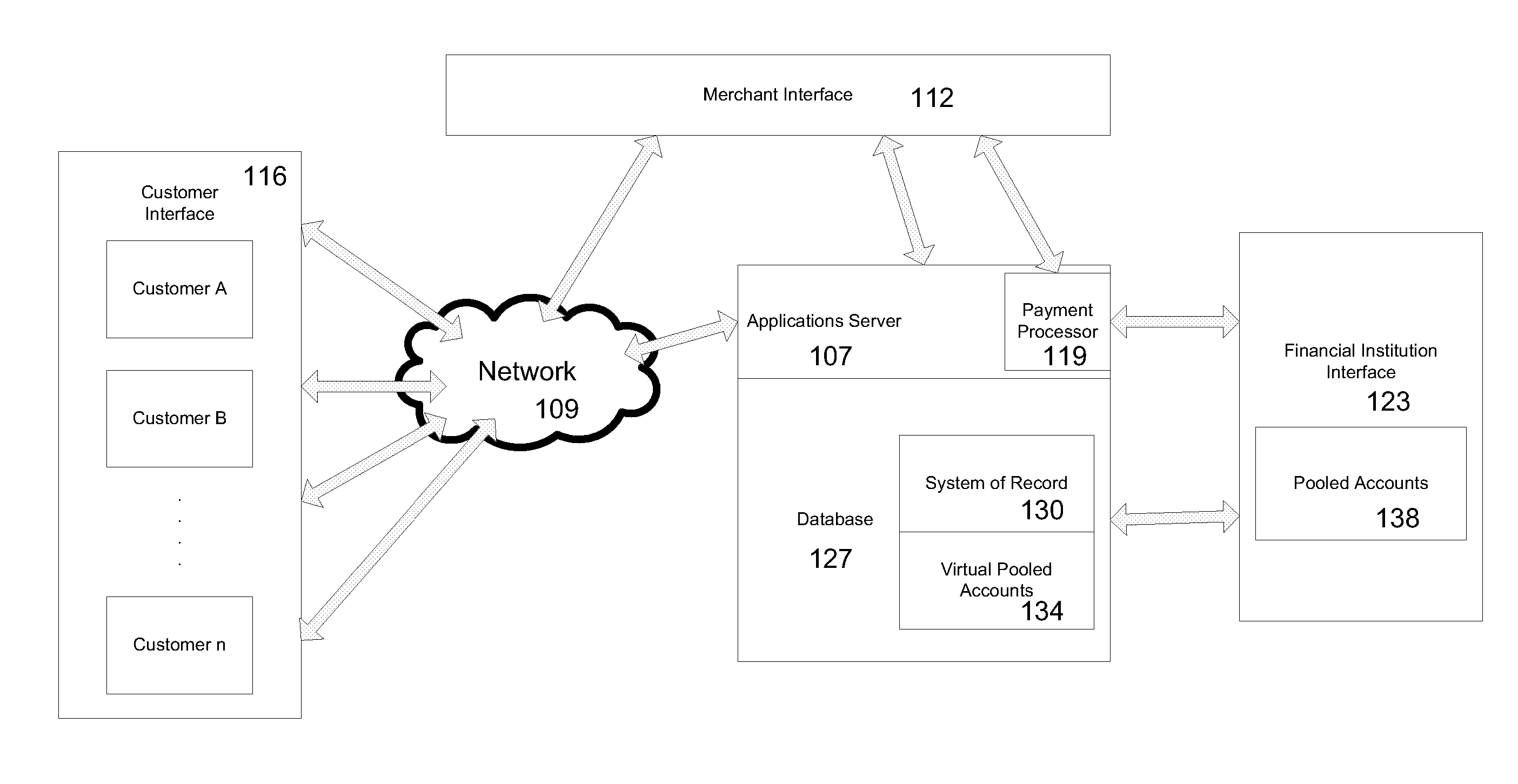

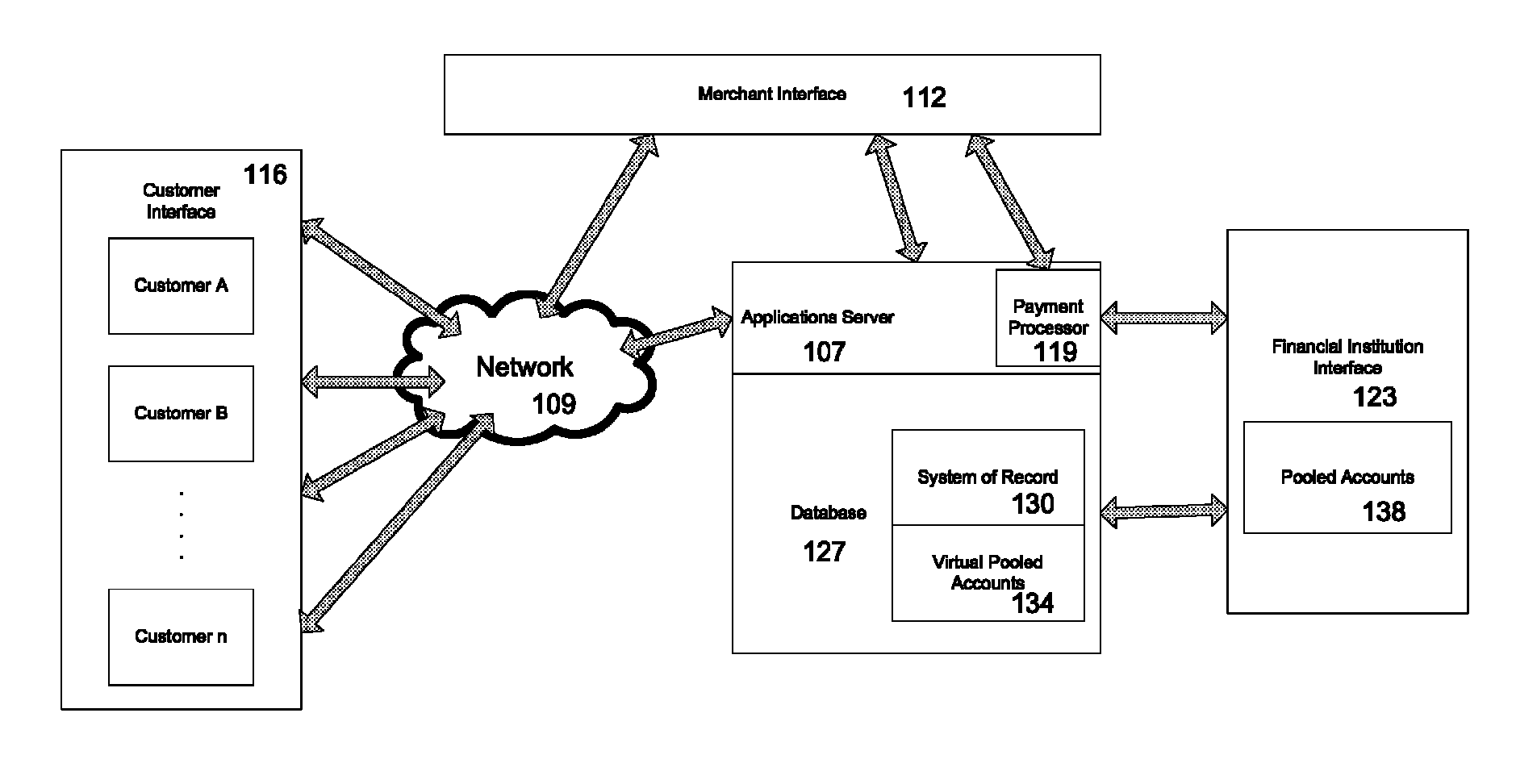

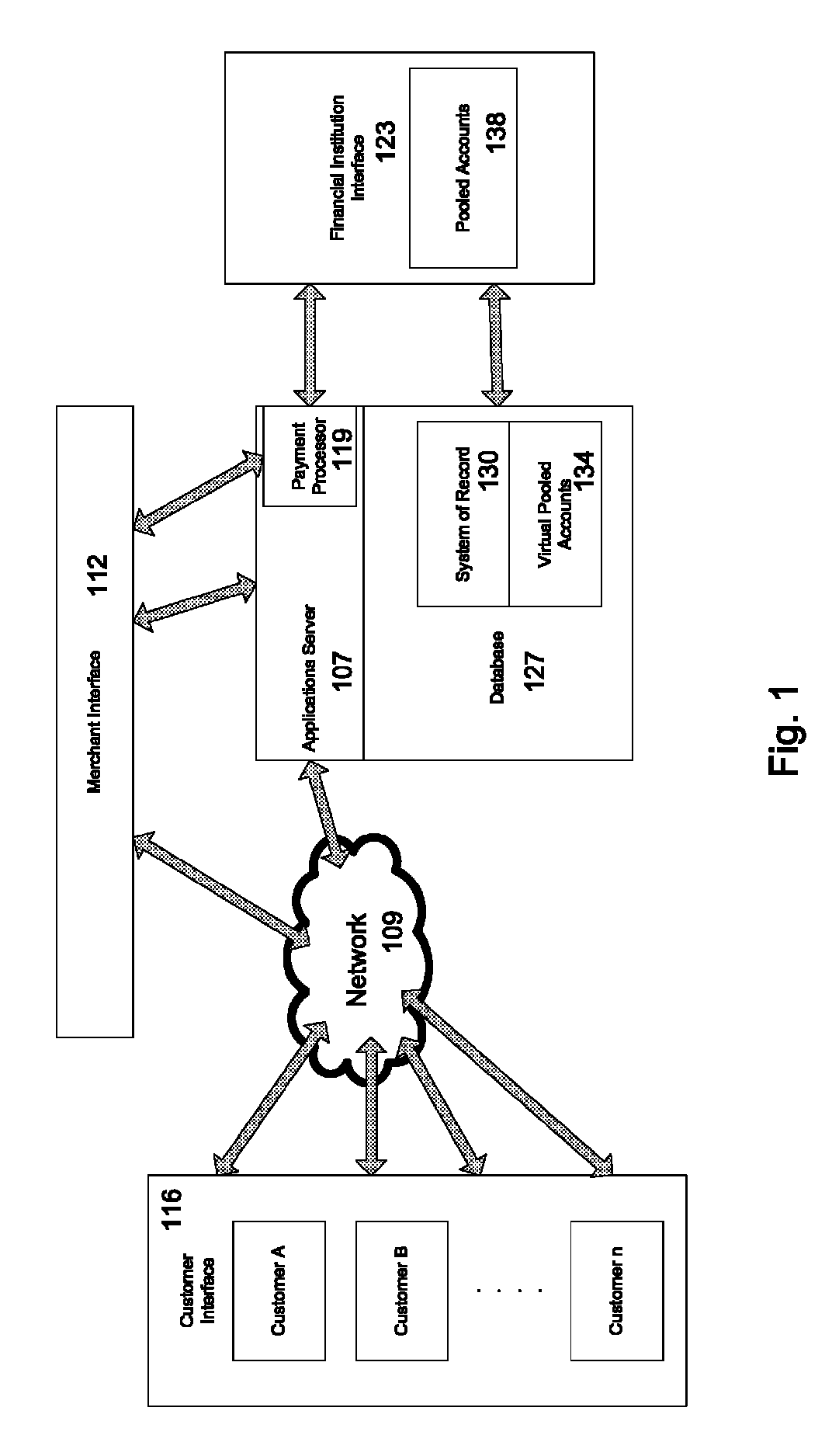

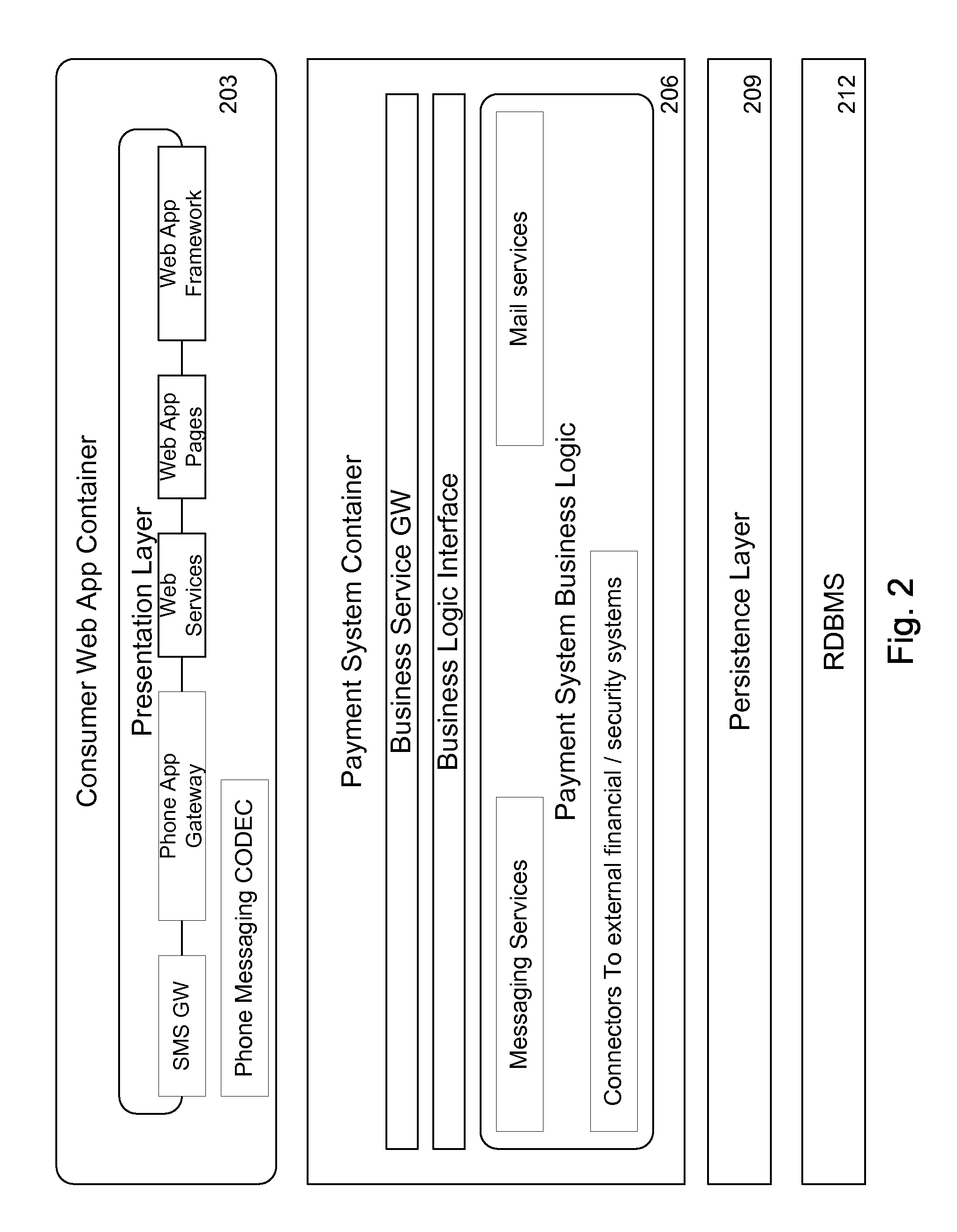

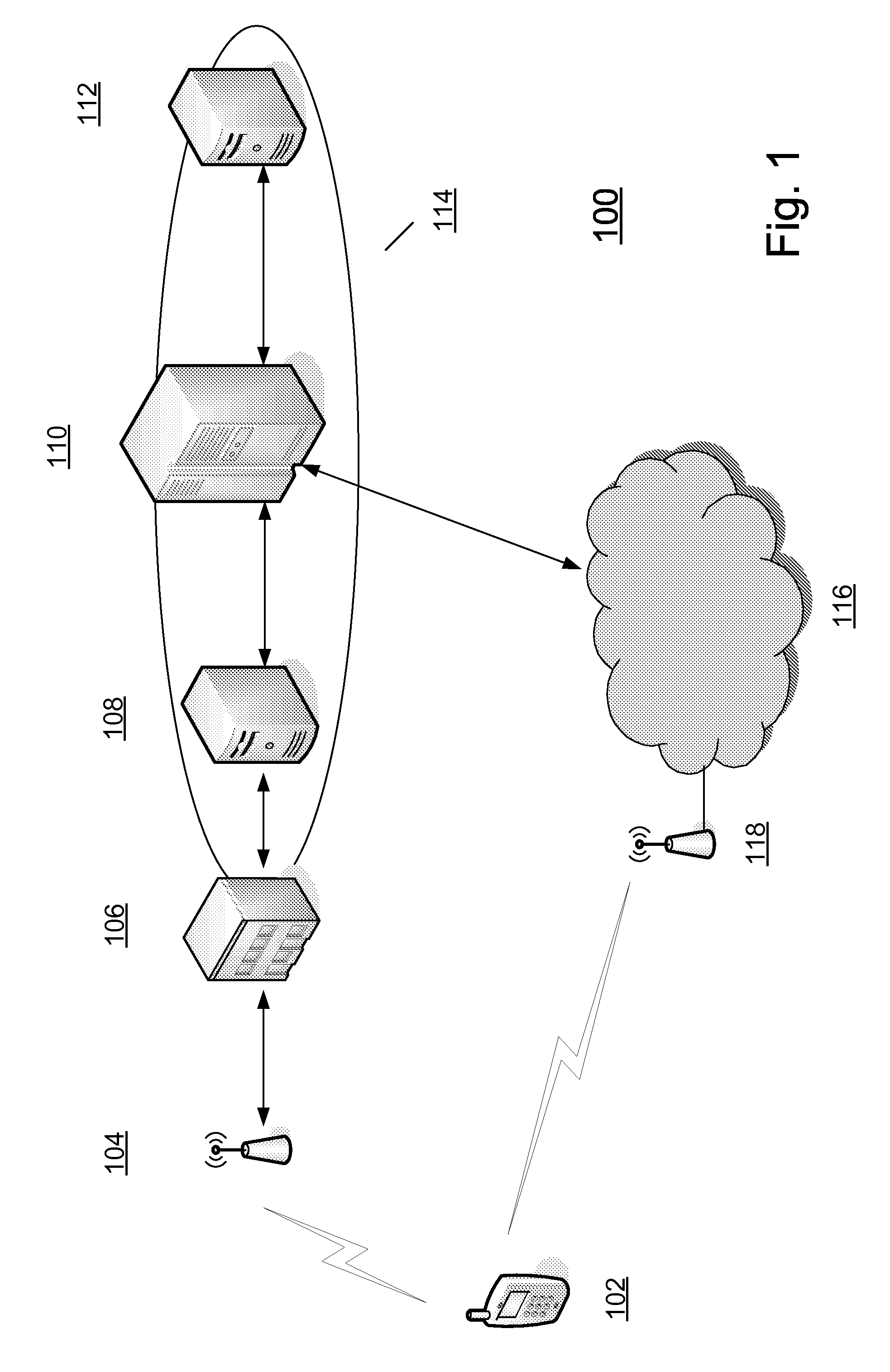

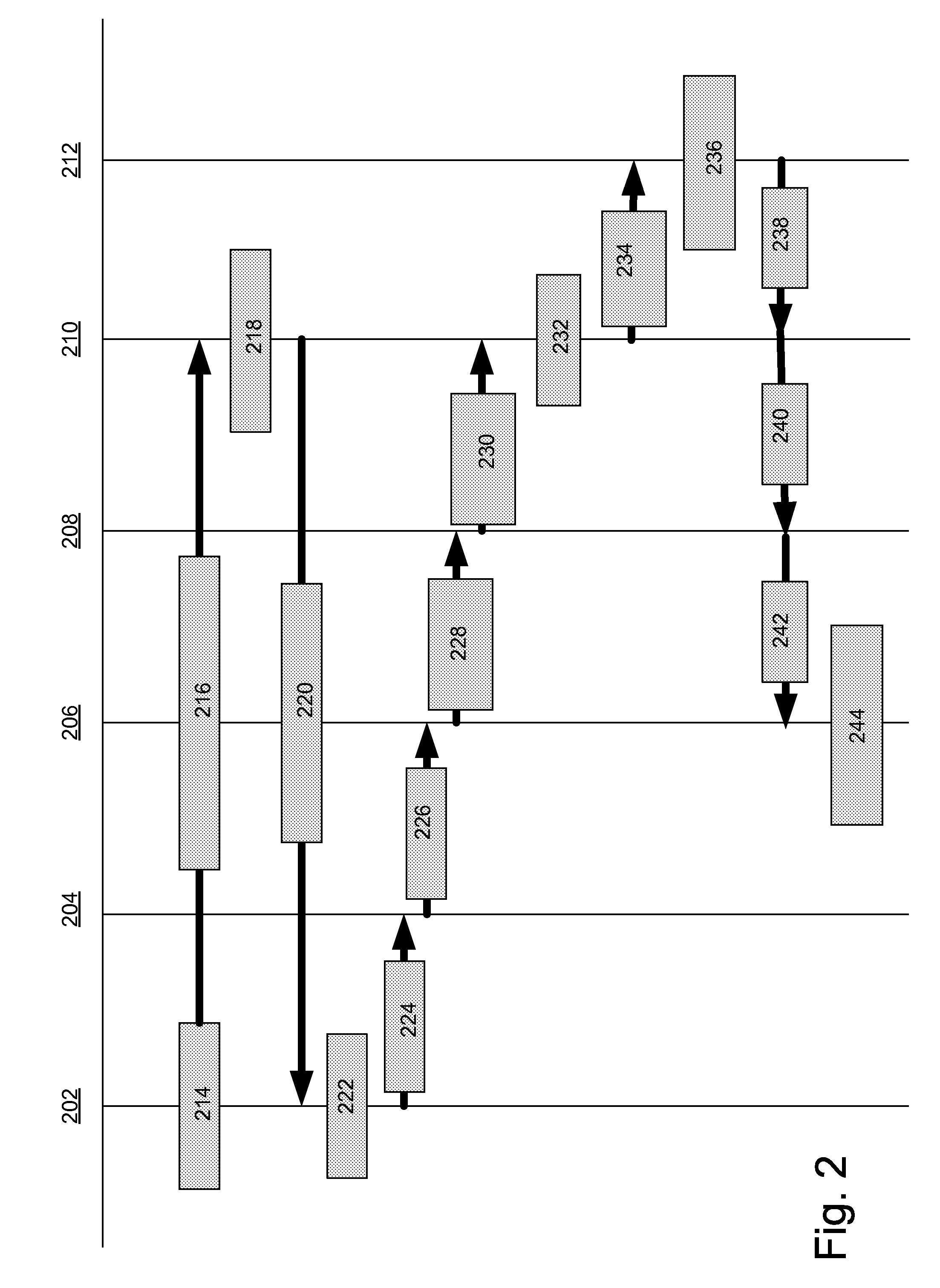

A mobile payment platform and service provides a fast, easy way to make payments by users of mobile devices. The platform also interfaces with nonmobile channels and devices such as e-mail, instant messenger, and Web. In an implementation, funds are accessed from an account holder's mobile device such as a mobile phone or a personal digital assistant to make or receive payments. Financial transactions can be conducted on a person-to-person (P2P) or person-to-merchant (P2M) basis where each party is identified by a unique indicator such as a telephone number or bar code. Transactions can be requested through any number of means including SMS messaging, Web, e-mail, instant messenger, a mobile client application, an instant messaging plug-in application or “widget.” The mobile client application, resident on the mobile device, simplifies access and performing financial transactions in a fast, secure manner.

Owner:OBOPAY MOBILE TECH INDIA PTE LTD

Wireless wallet

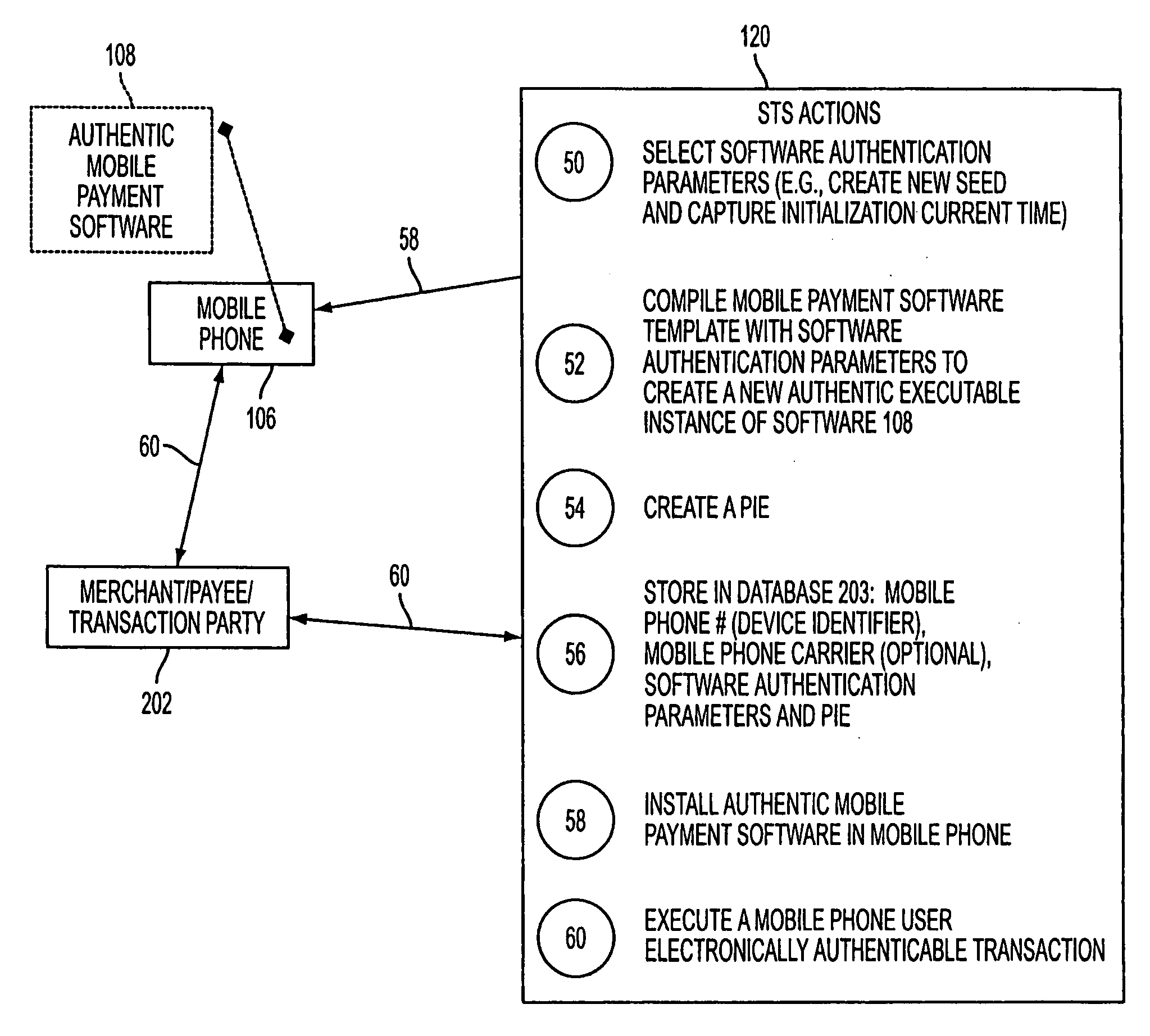

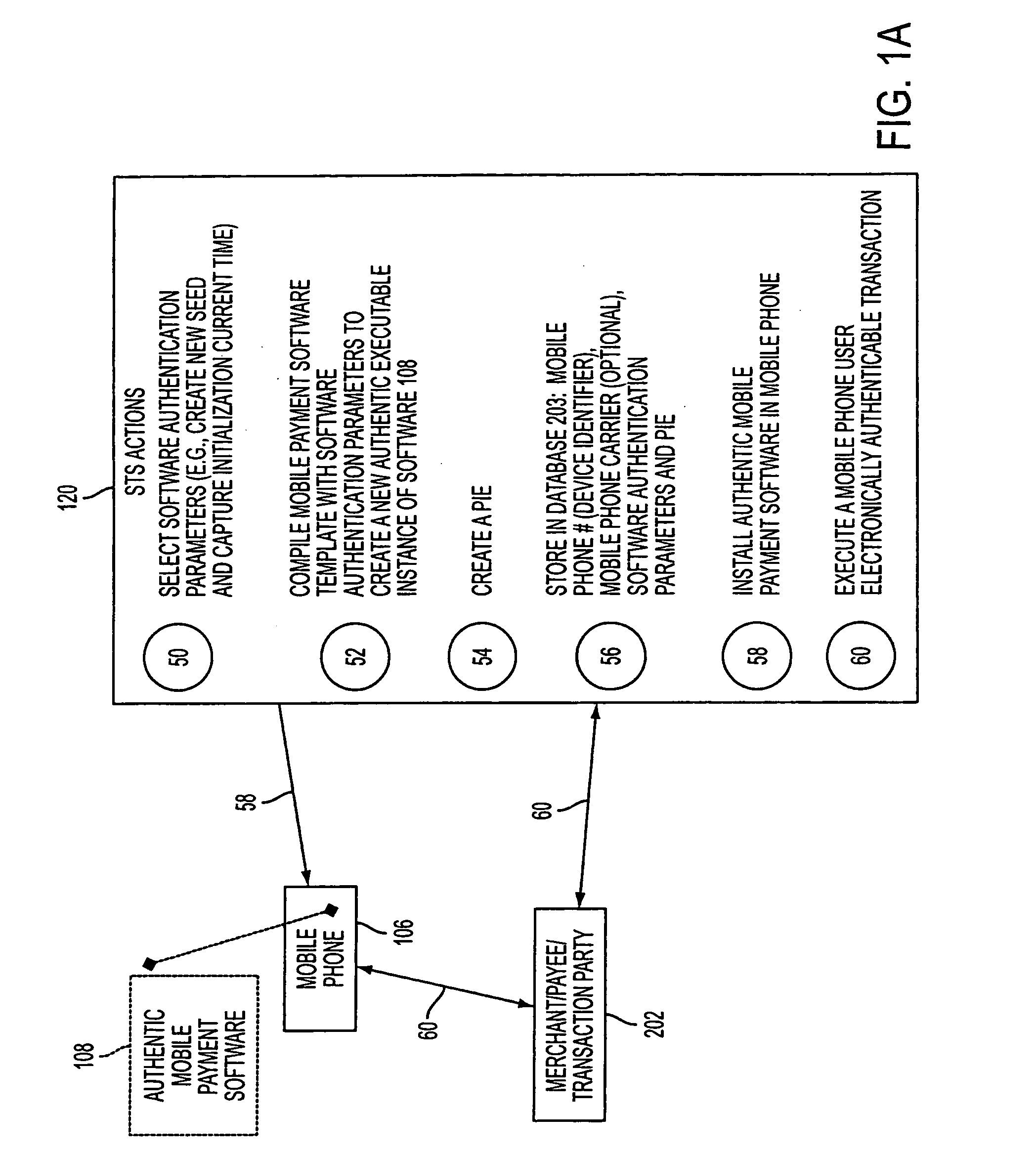

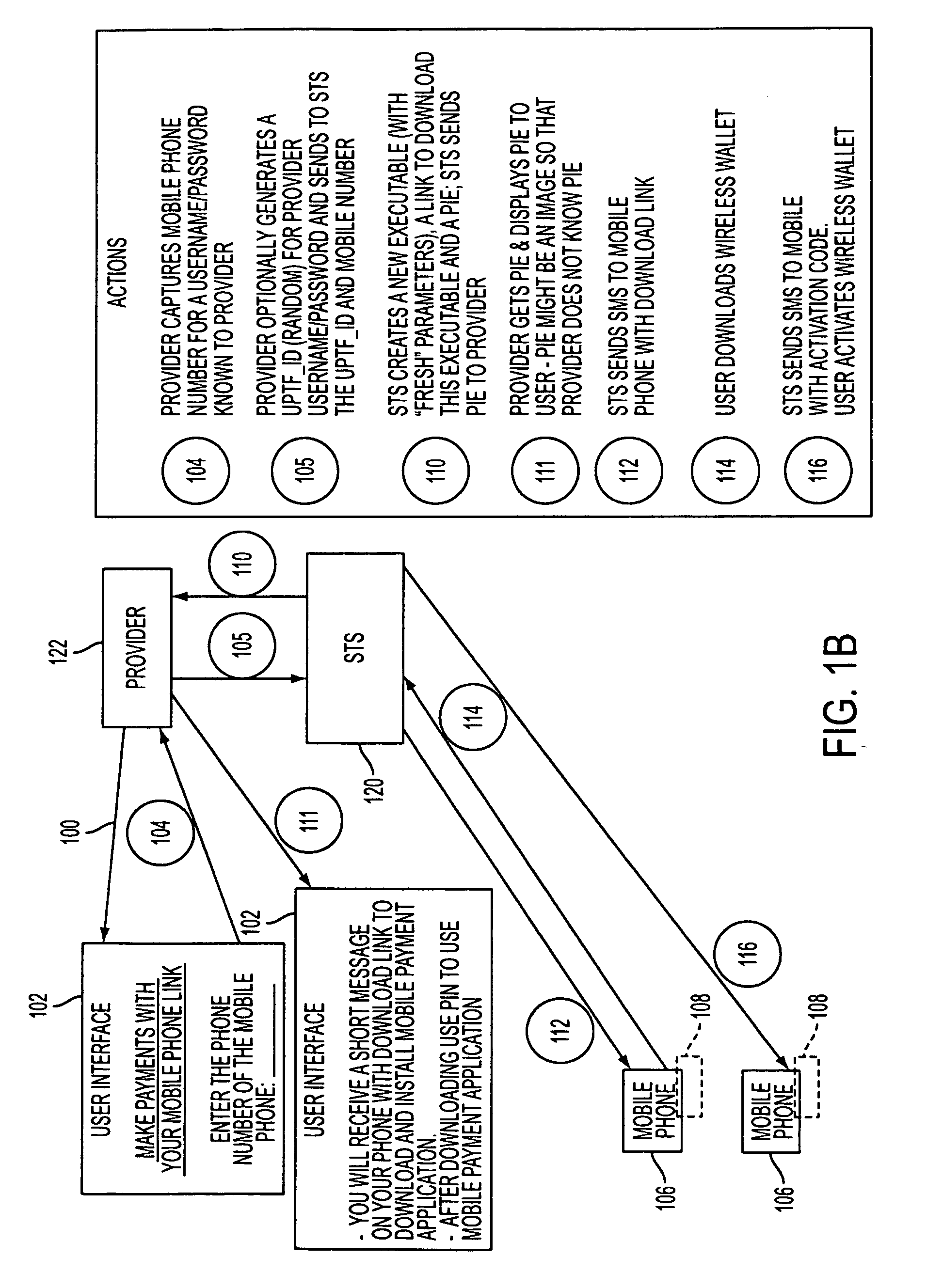

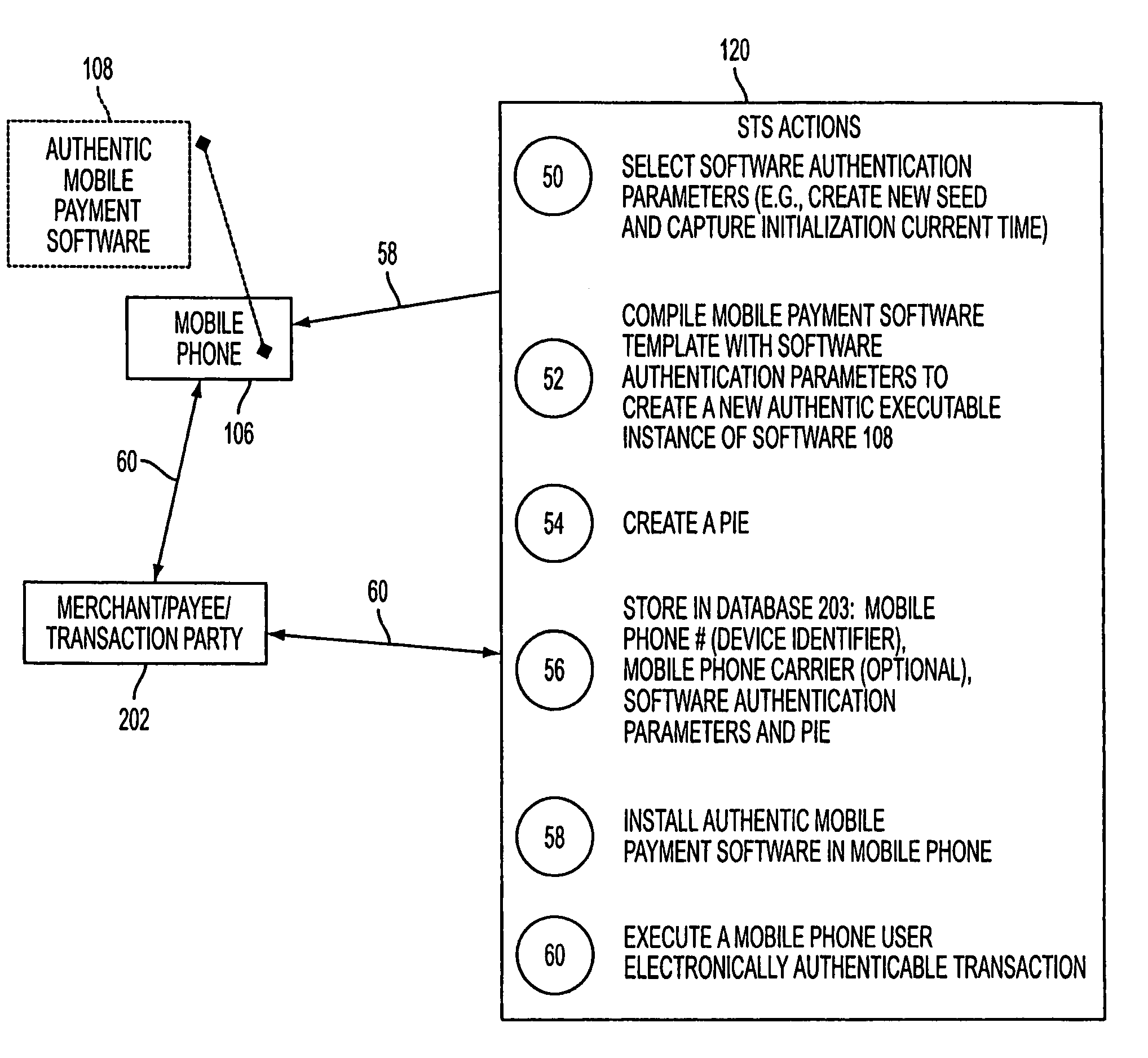

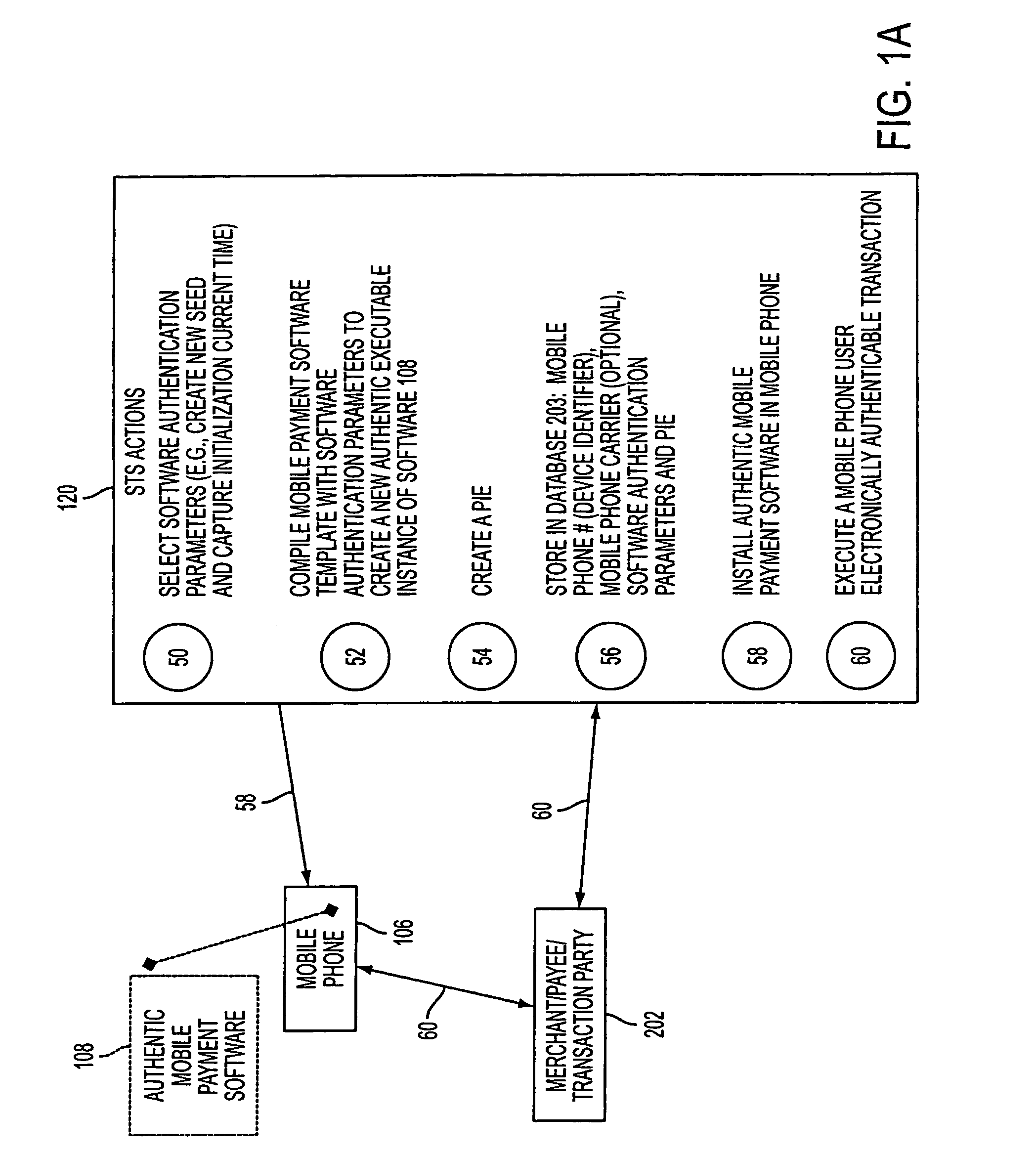

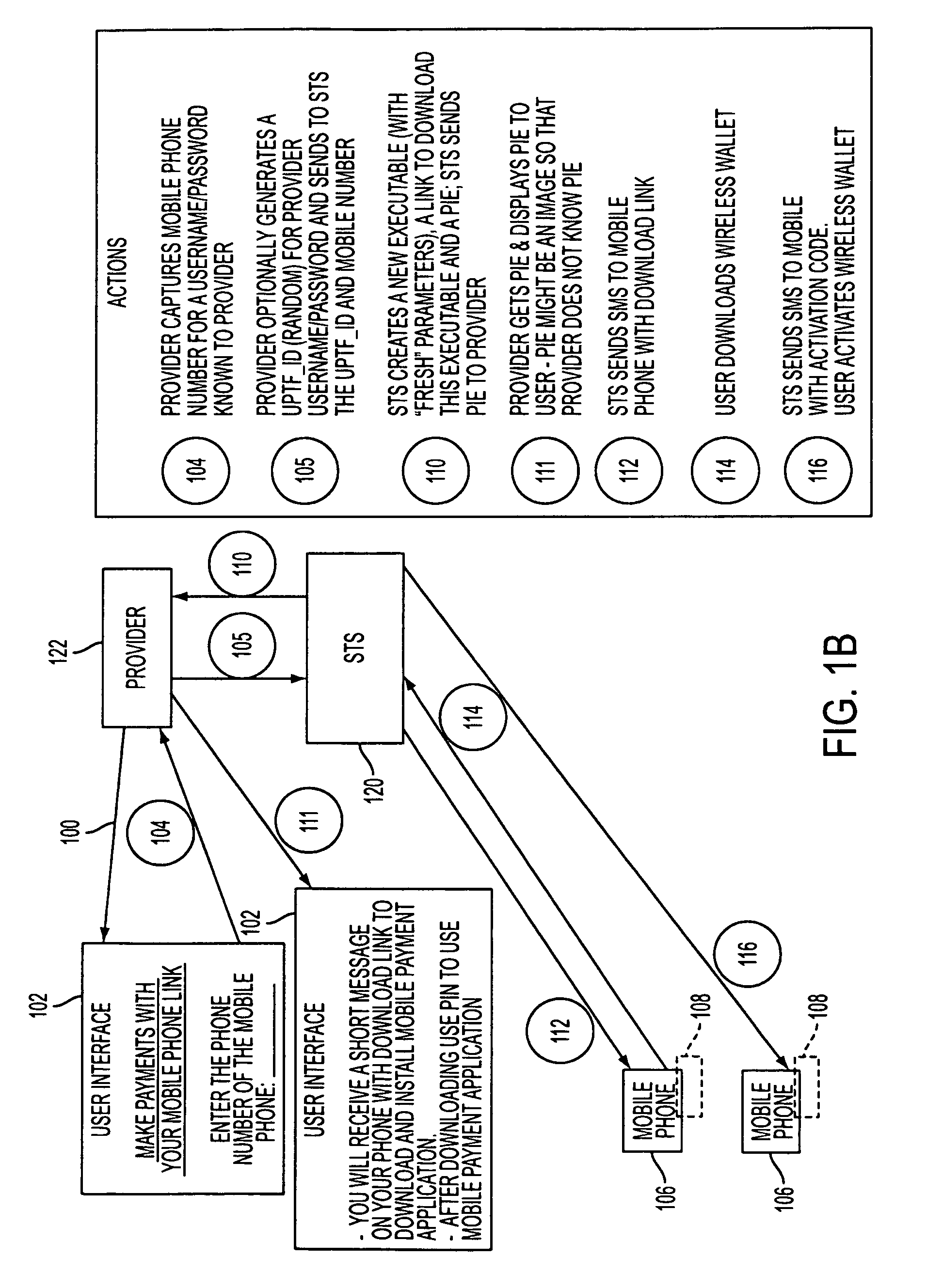

A mobile phone system and method of initializing, at a secure transaction server (STS), a mobile payment software with a software authentication parameter, as an authentic mobile payment software; providing an STS correlation between a personal identification entry (PIE) and the authentic mobile payment software; installing, in a mobile phone, the authentic mobile payment software; and inputting, by a user, the PIE to the installed authentic mobile payment software to generate according to the PIE and the software authentication parameter a transformed secure authenticable mobile phone cashless monetary transaction over the mobile phone network, as a mobile phone wireless wallet of the user of the mobile phone. The mobile phone authenticable cashless monetary transaction is performed according to an agreement view(s) protocol.

Owner:PCMS HOLDINGS INC

Methods and Systems For Making a Payment Via A Stored Value Card in a Mobile Environment

ActiveUS20080040265A1Unprecedented convenienceUnprecedented flexibilityFinanceBilling/invoicingFinancial transactionMobile context

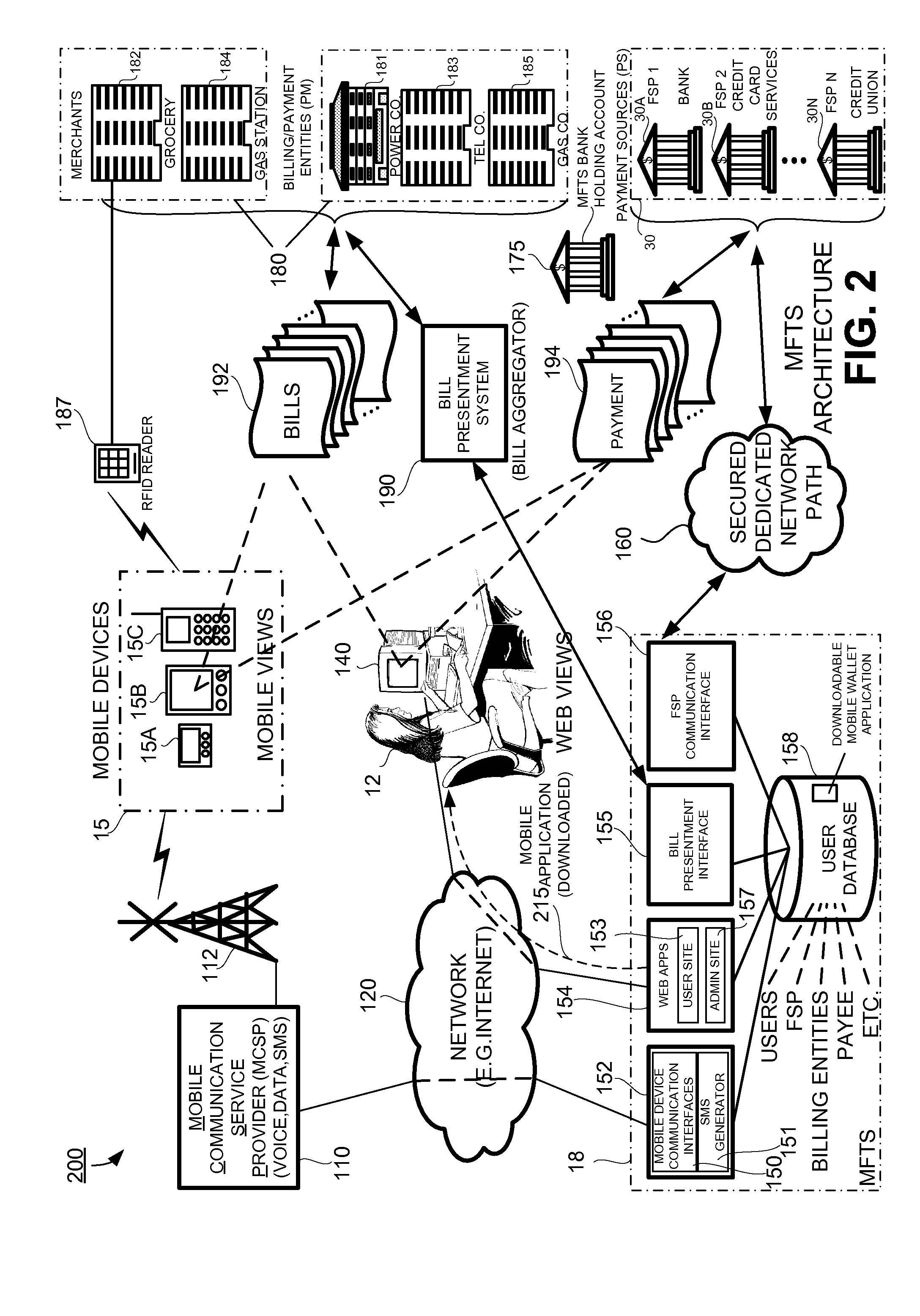

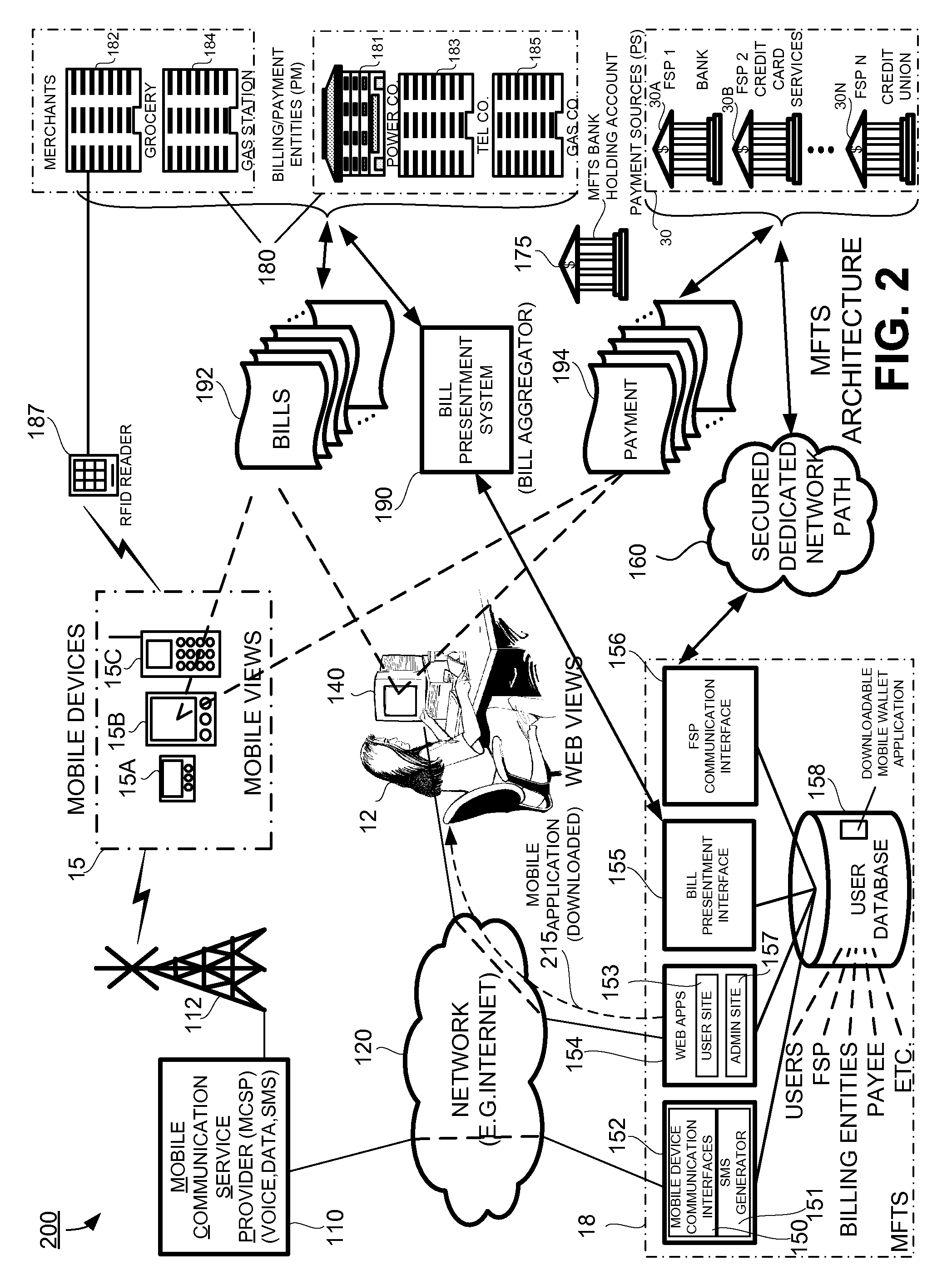

Methods and systems for making a financial payment to a payee via a stored value (SV) card utilizing a mobile device such as a mobile telephone (cellphone) or wireless connected personal digital assistant (PDA). The mobile device communicates wirelessly with a mobile financial transaction system (MFTS) that stores user information and transaction information. A user enters information via the mobile device identifying a payee and indicating a stored value card payment method. The mobile device generates a mobile payment instruction that includes information corresponding to the identified payee and indicating a stored value card payment method. The mobile payment instruction is wirelessly communicated to the MFTS. The MFTS generates an MFTS payment instruction to a payment instruction recipient that can issue a new stored value card and / or reload funds onto a pre-existing stored value card. The MFTS communicates the MFTS payment instruction to the payment instruction recipient, which arranges for payment to the identified payee by issuing a new stored value card or reloading funds onto a pre-existing stored value card.

Owner:QUALCOMM INC

Mobile Person-to-Person Payment System

InactiveUS20070255652A1The process is simple and fastSimple accessFinancePayment architectureBarcodeFinancial transaction

A mobile payment platform and service provides a fast, easy way to make payments by users of mobile devices. The platform also interfaces with nonmobile channels and devices such as e-mail, instant messenger, and Web. In an implementation, funds are accessed from an account holder's mobile device such as a mobile phone or a personal digital assistant to make or receive payments. Financial transactions may be conducted on a person-to-person (P2P) or person-to-merchant (P2M) basis where each party is identified by a unique indicator such as a telephone number or bar code. Transactions may be requested through any number of means including SMS messaging, Web, e-mail, instant messenger, a mobile client application, an instant messaging plug-in application or “widget.” The mobile client application, resident on the mobile device, simplifies access and performing financial transactions in a fast, secure manner.

Owner:OBOPAY MOBILE TECH INDIA PTE LTD

Transacting Mobile Person-to-Person Payments

InactiveUS20070255620A1The process is simple and fastSimplifies access and performing financial transactionFinancePayment architectureTelecommunicationsMobile payment

In a mobile payment system, registered users or members may send payment to other member or unregistered users or nonmembers. In a specific implementation, a person-to-person payment system allows existing members of a payment system to send funds to nonmembers with the intent that the nonmember becomes a member. This ability of a payment system may be referred to as “viral” because it promotes new member registrations in an exponential spreading fashion.

Owner:OBOPAY INC

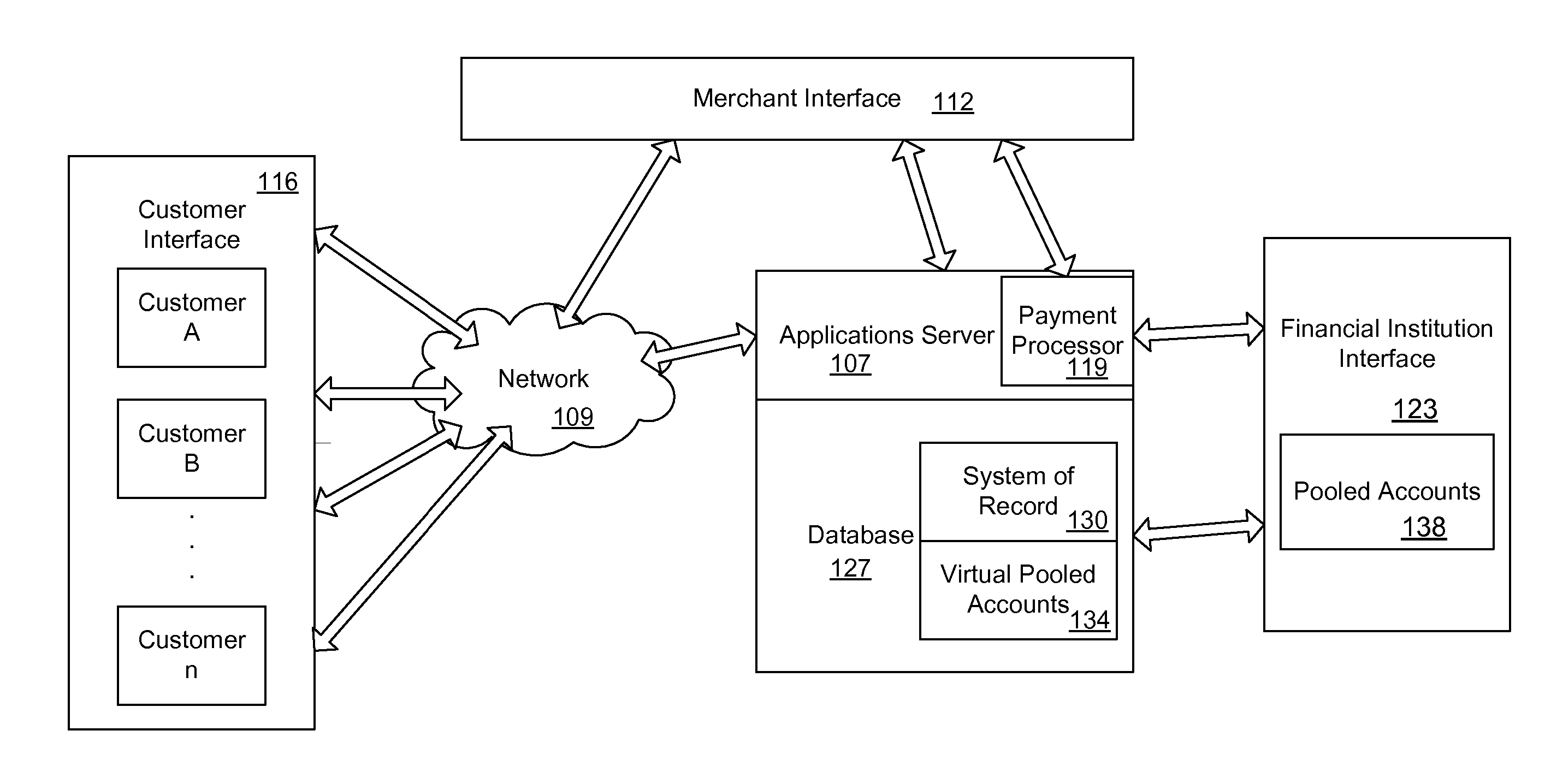

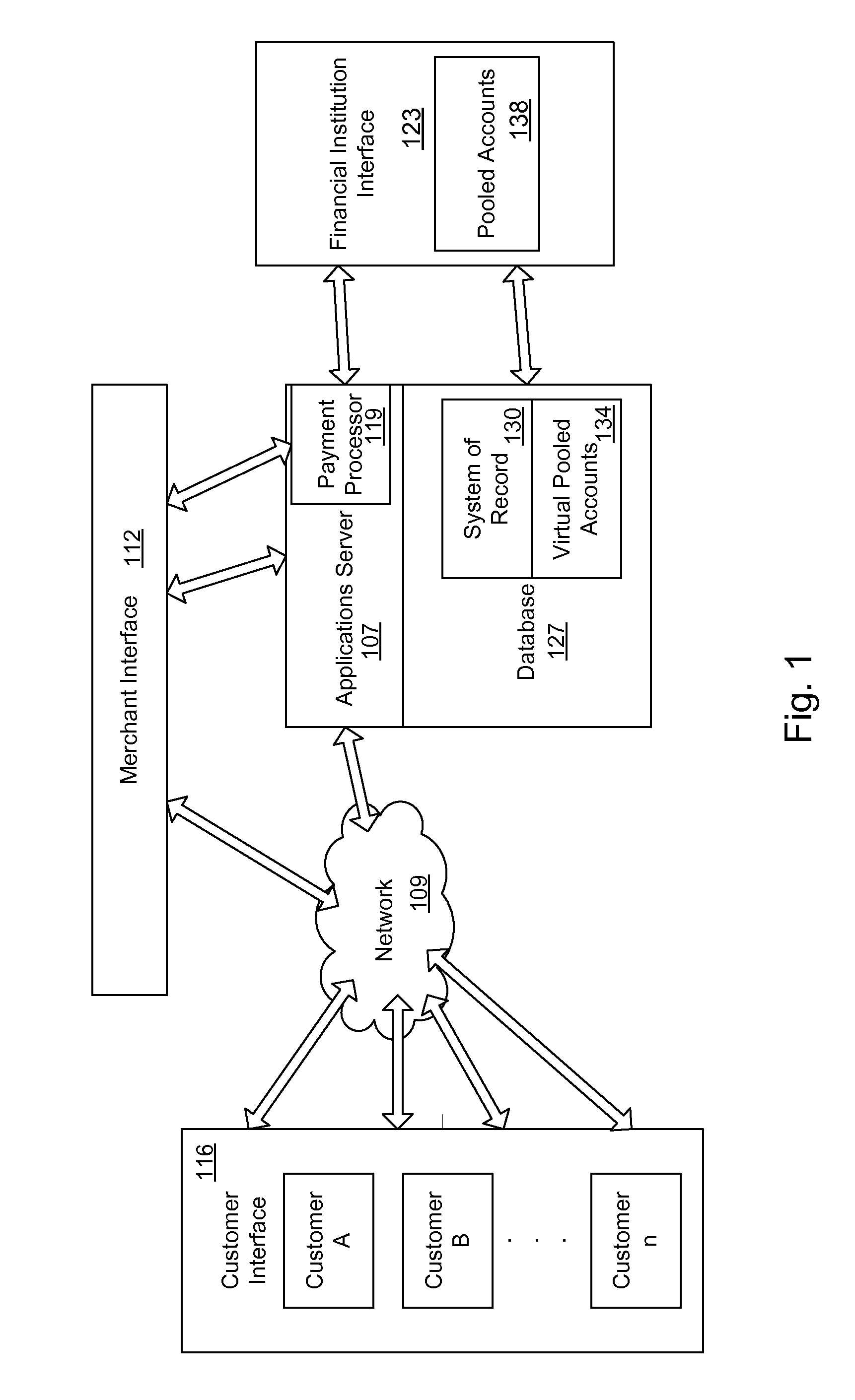

Member-Supported Mobile Payment System

InactiveUS20070233615A1Facilitates manualFacilitates automated load functionalityFinancePayment architectureWireless handheld devicesMobile payment

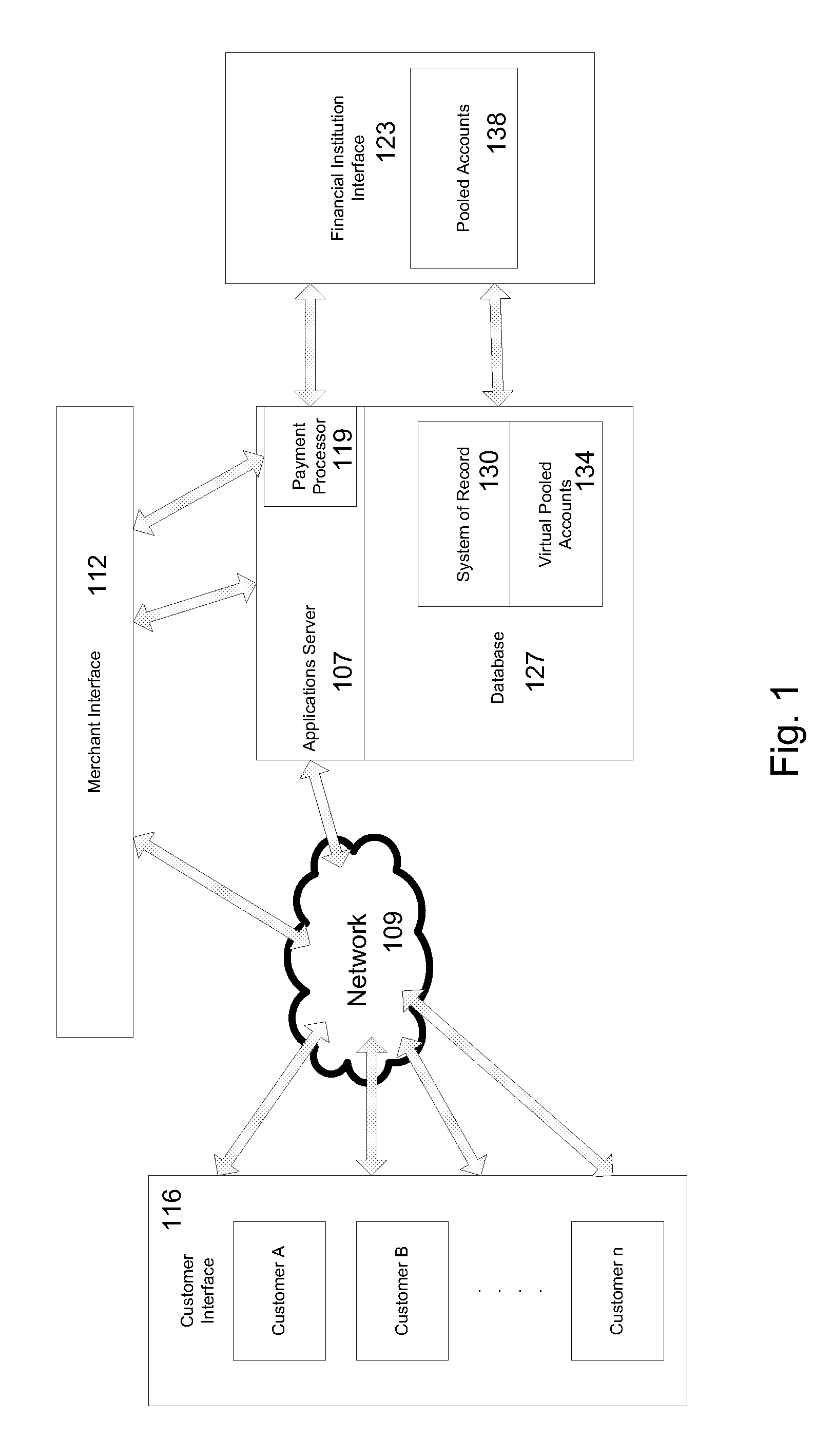

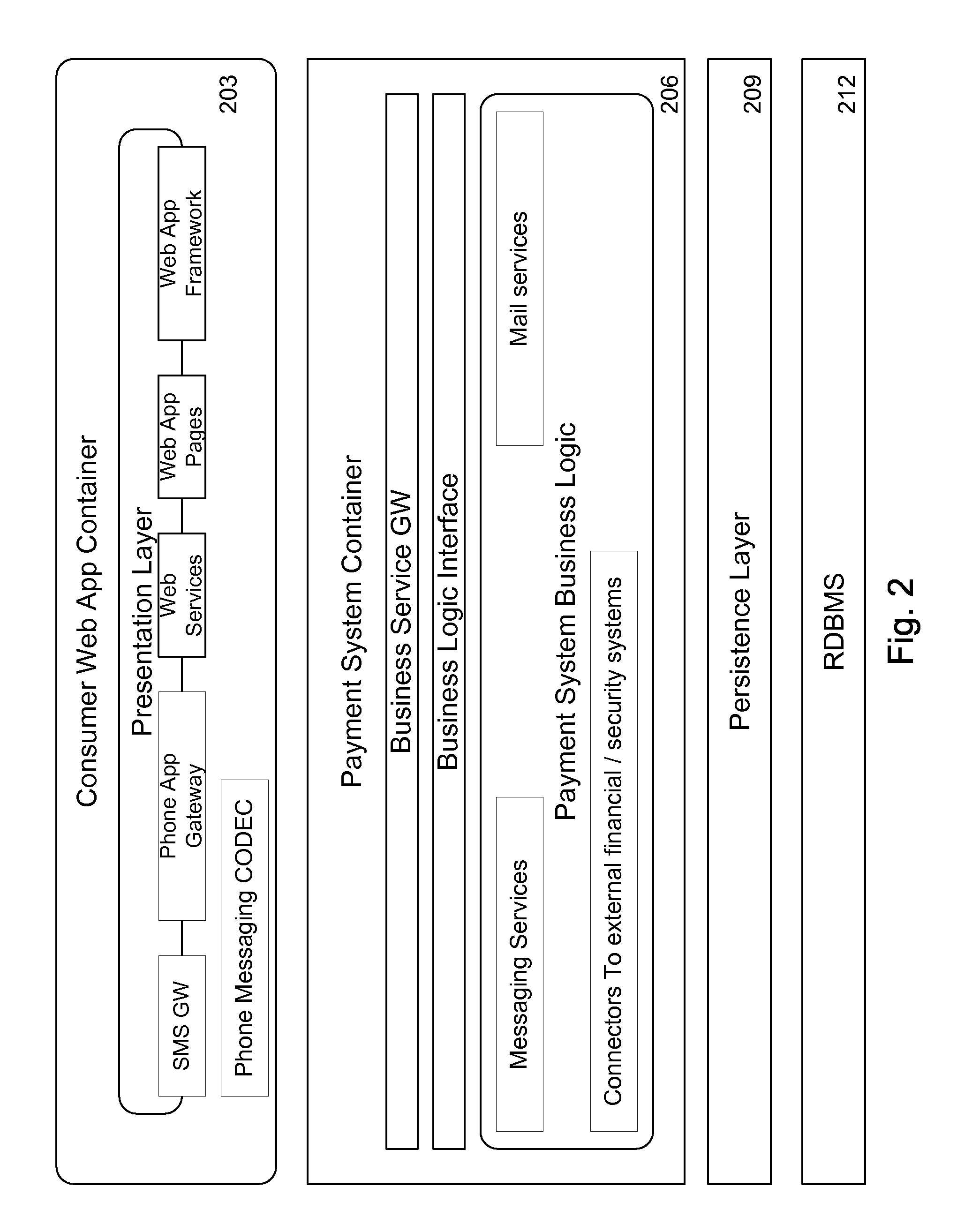

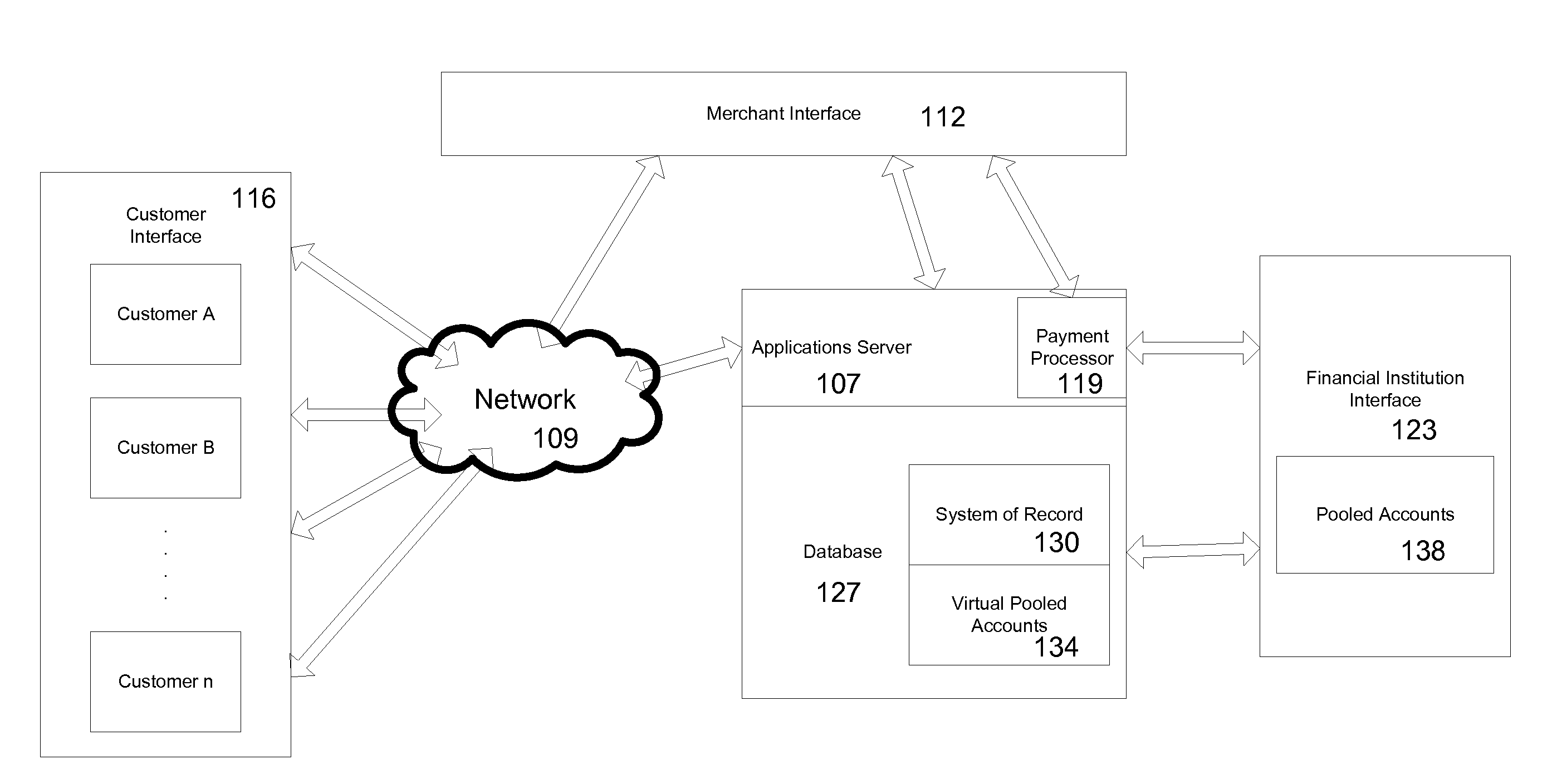

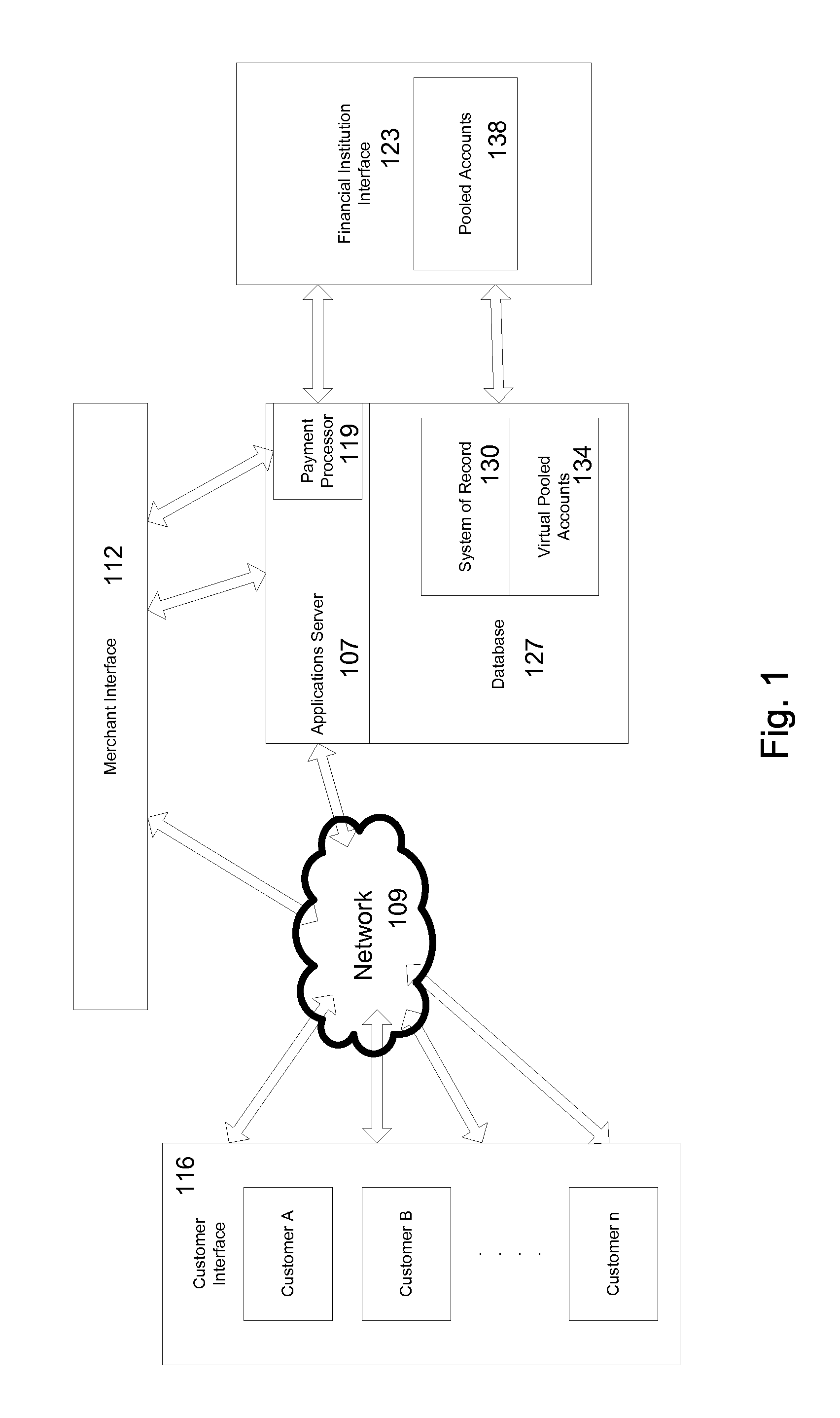

A member-supported payment system is available to consumers and merchants without sign-up fees, subscription fees, or transaction fees to either consumers or merchants. In a specific implementation, the member payment system is a mobile payment system where consumers may conduct transactions using a mobile device such as a mobile telephone, smartphone, personal digital assistant, or similar portable wireless handheld device. Merchants will make a refundable one-time contribution. These contributions are stored in a pooled trust account by the system and the float dividends or interest on these contributions will fund the system.

Owner:OBOPAY MOBILE TECH INDIA PTE LTD

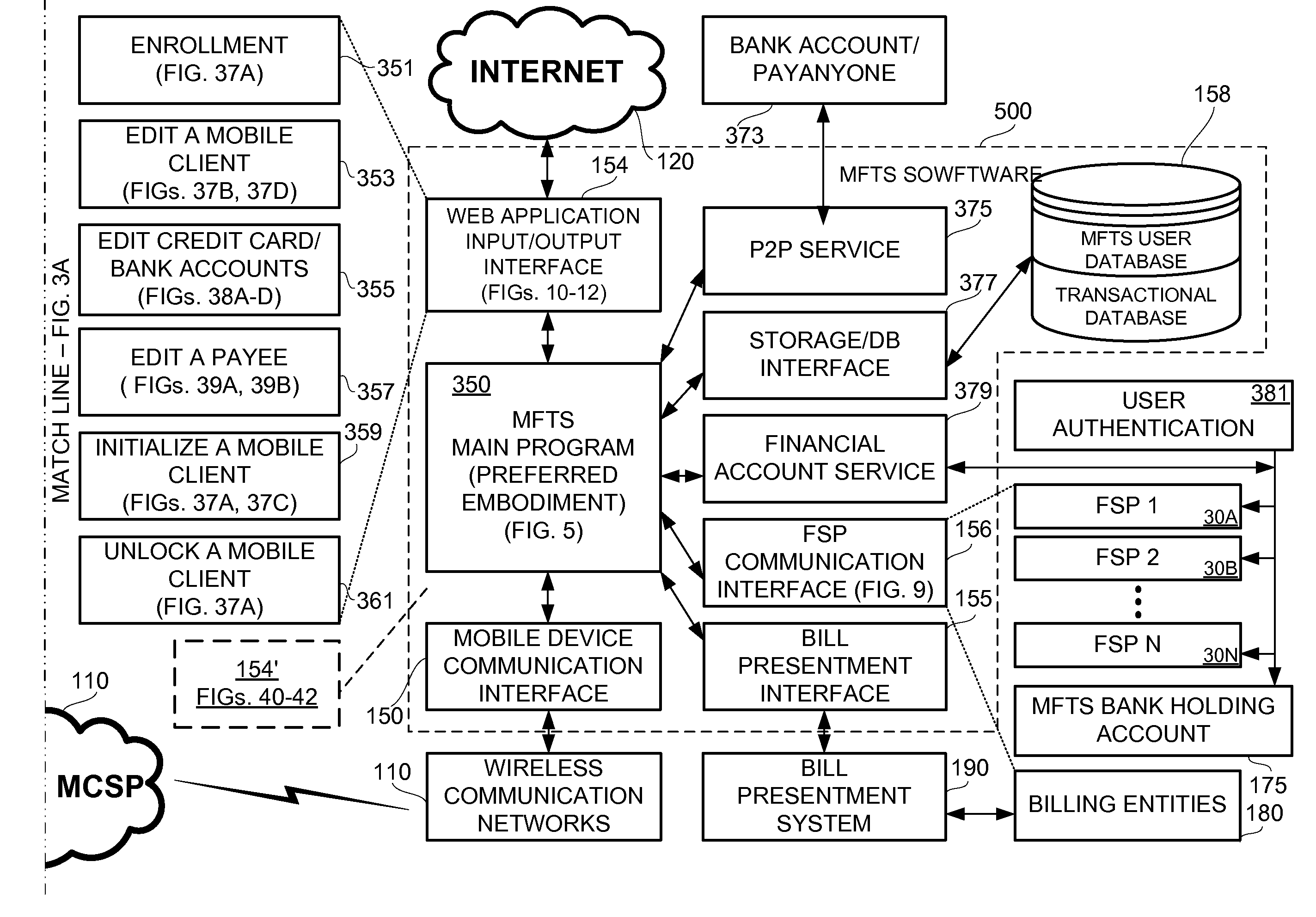

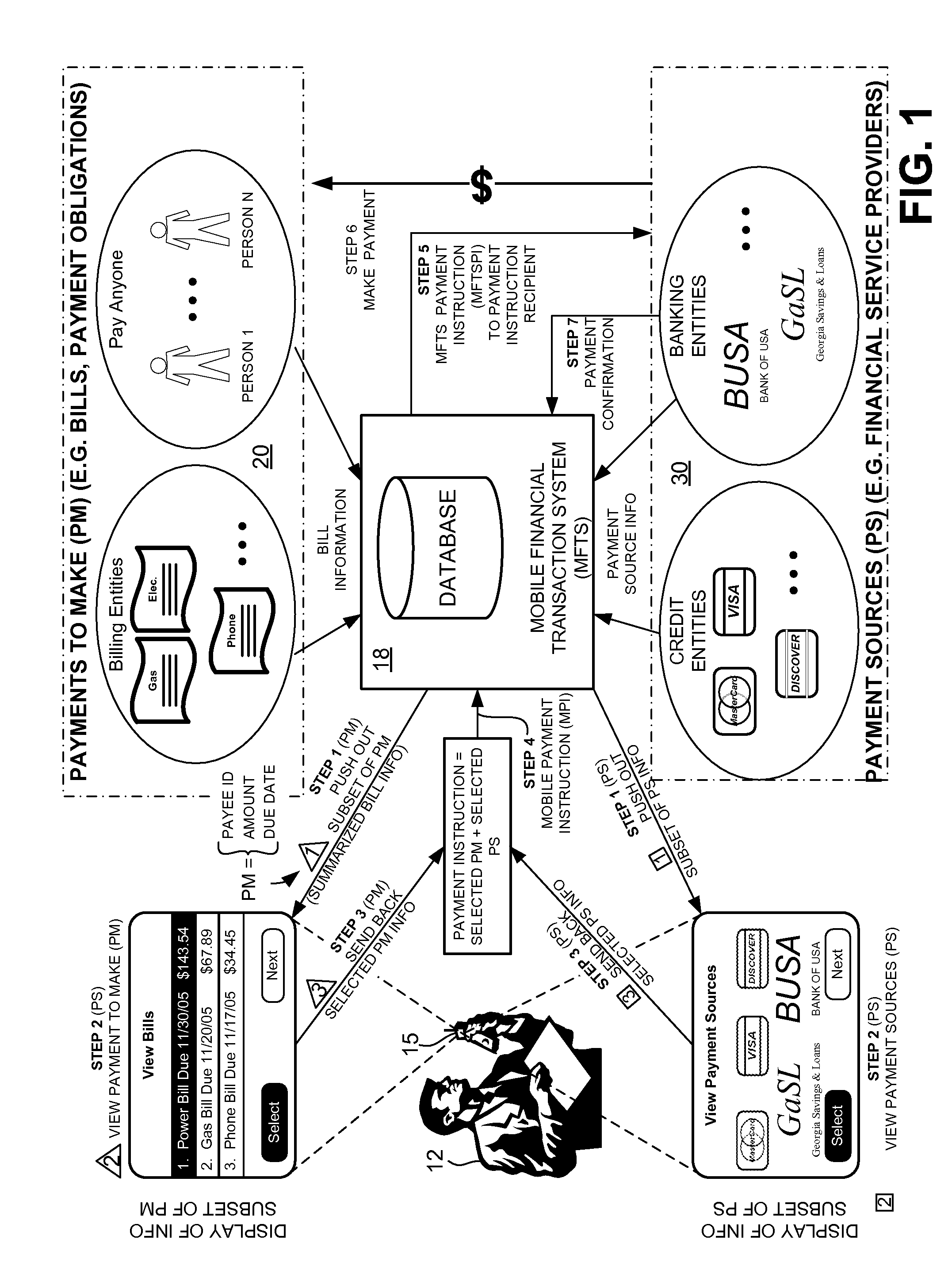

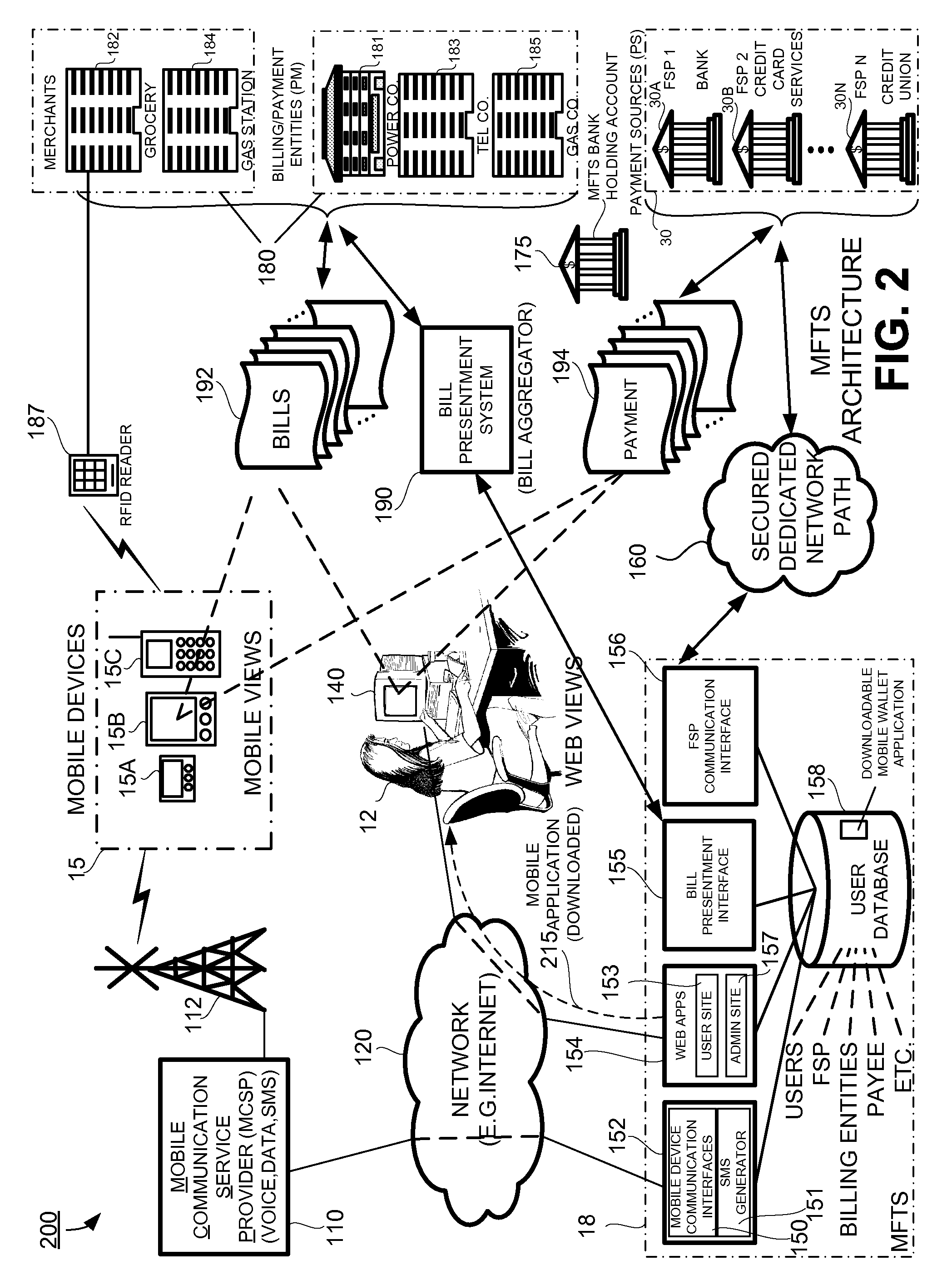

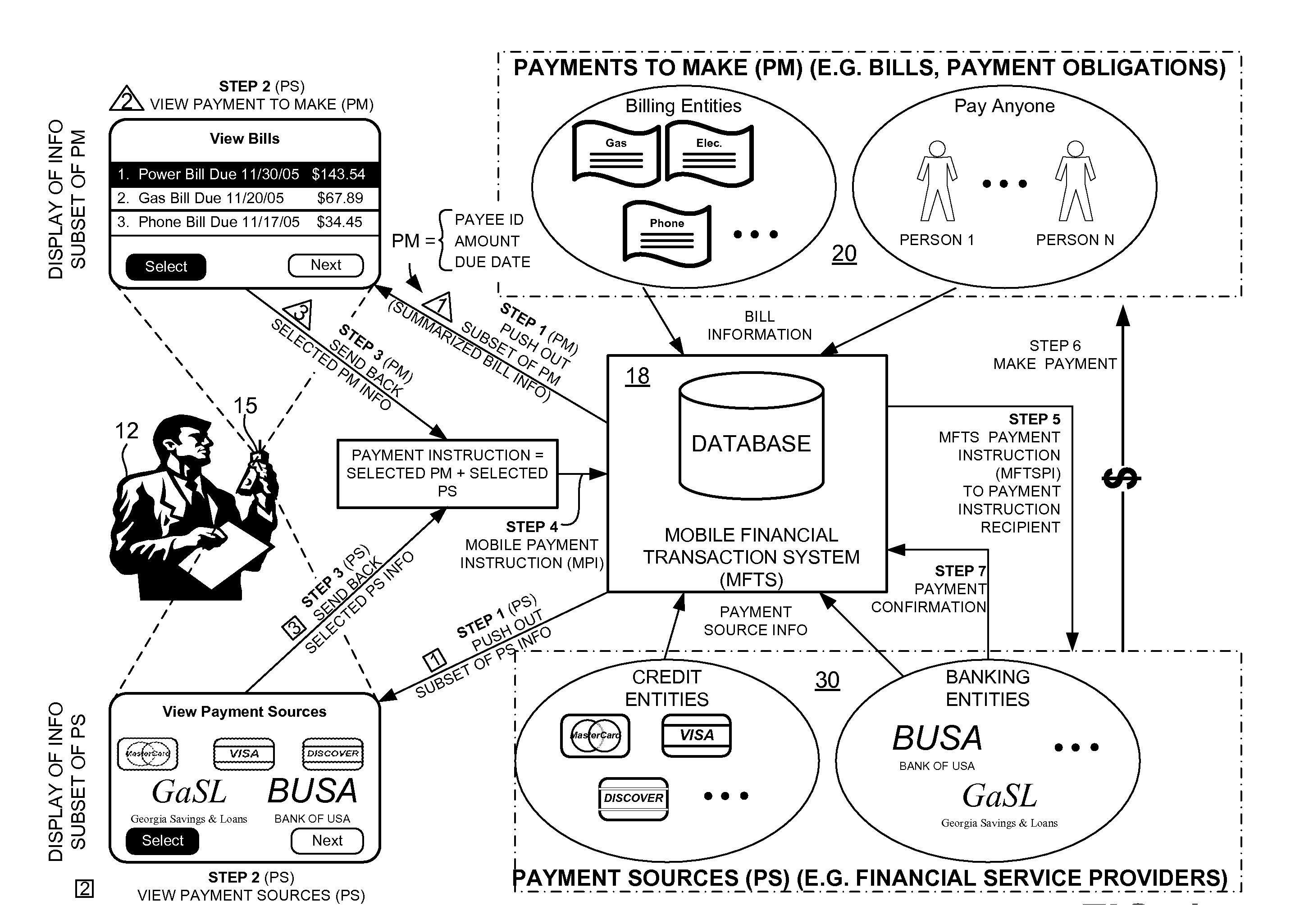

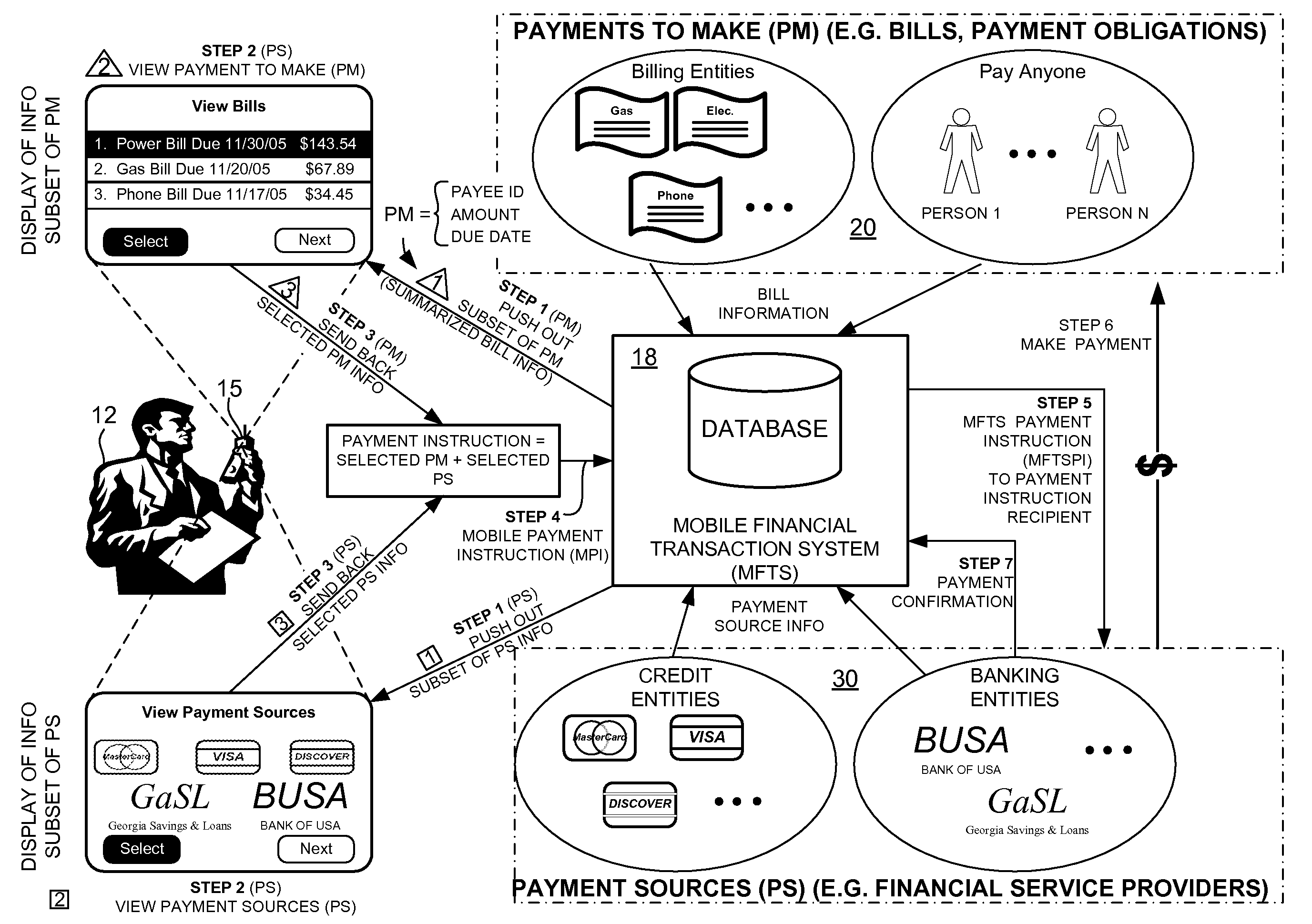

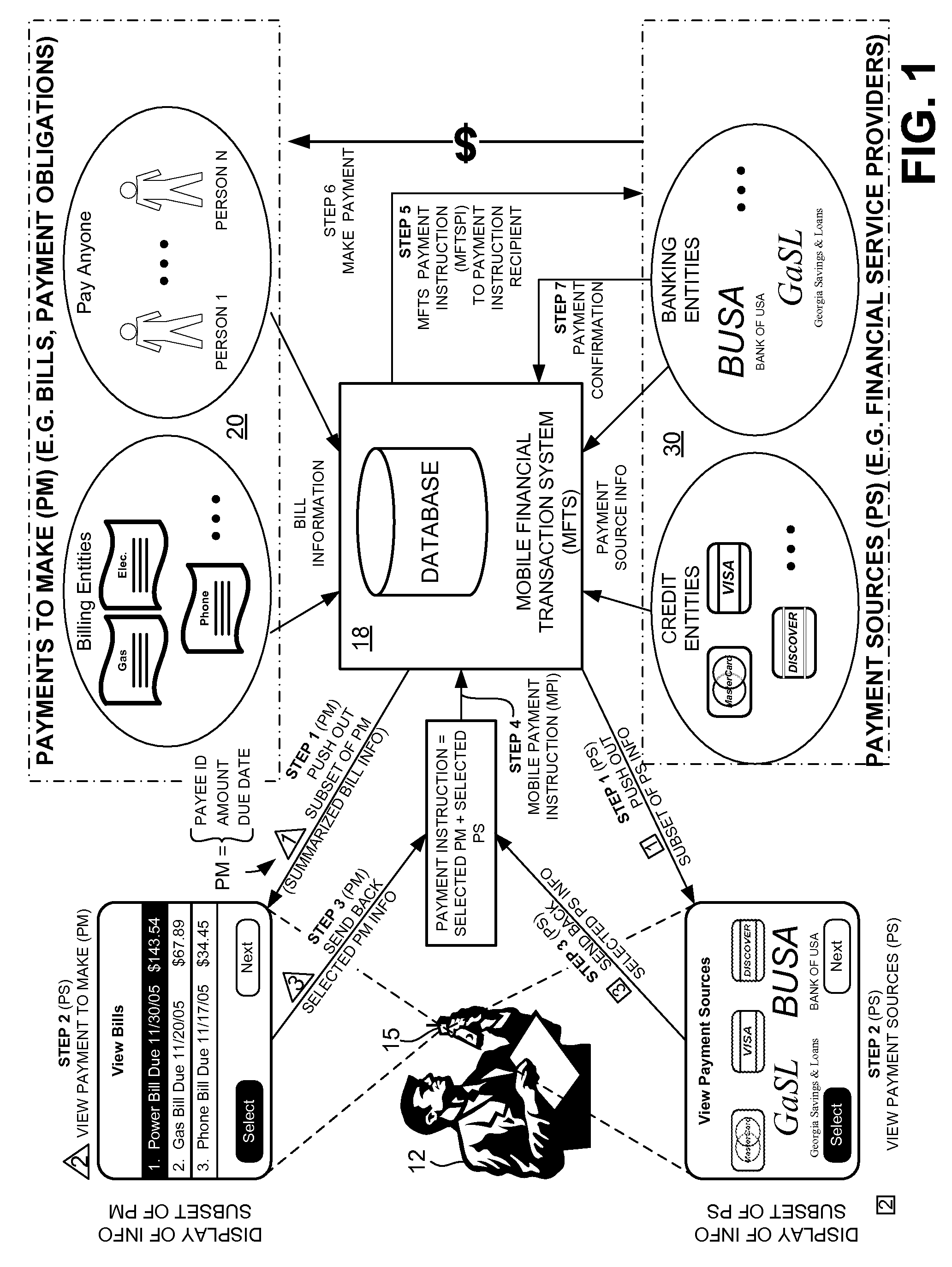

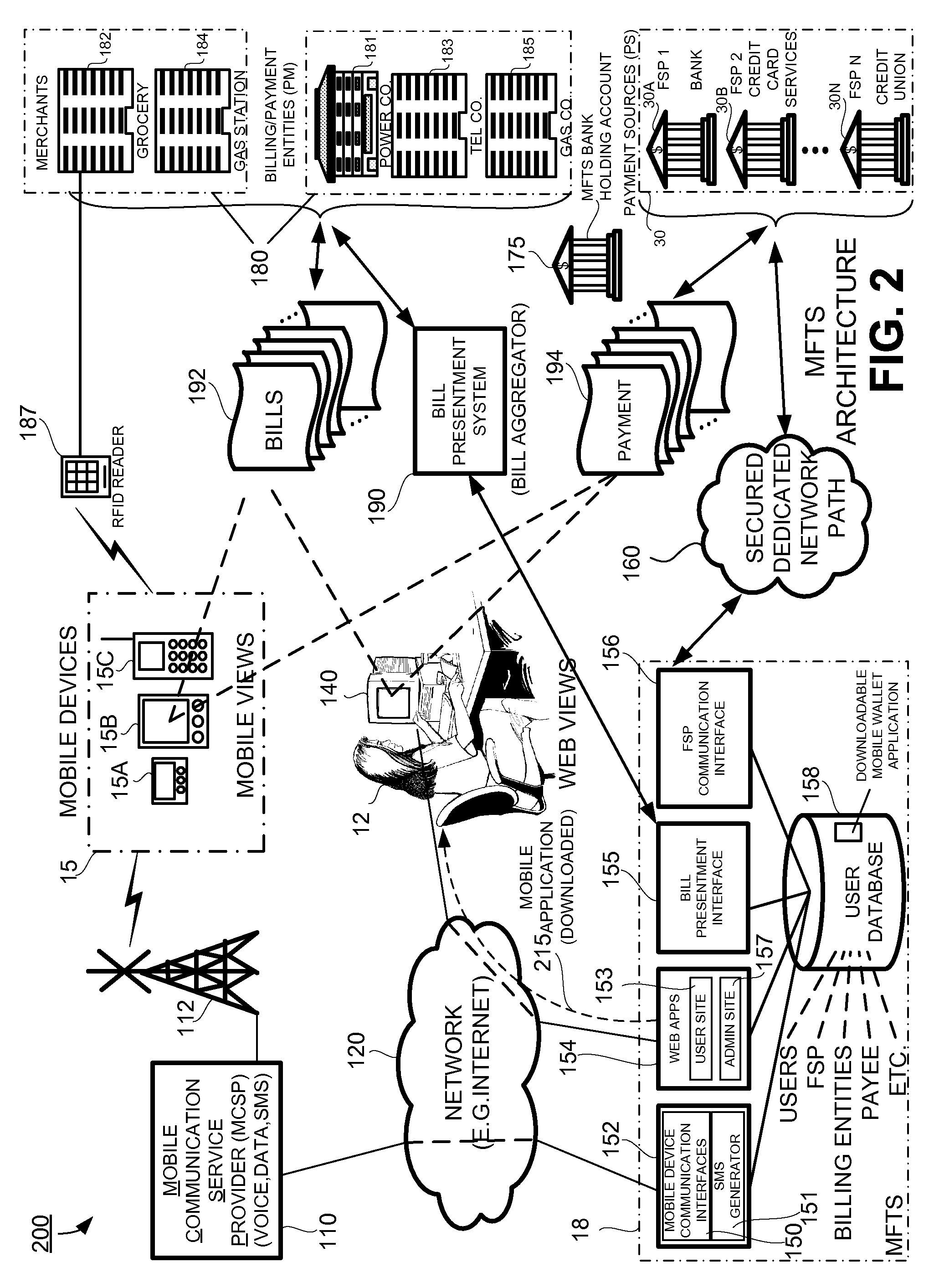

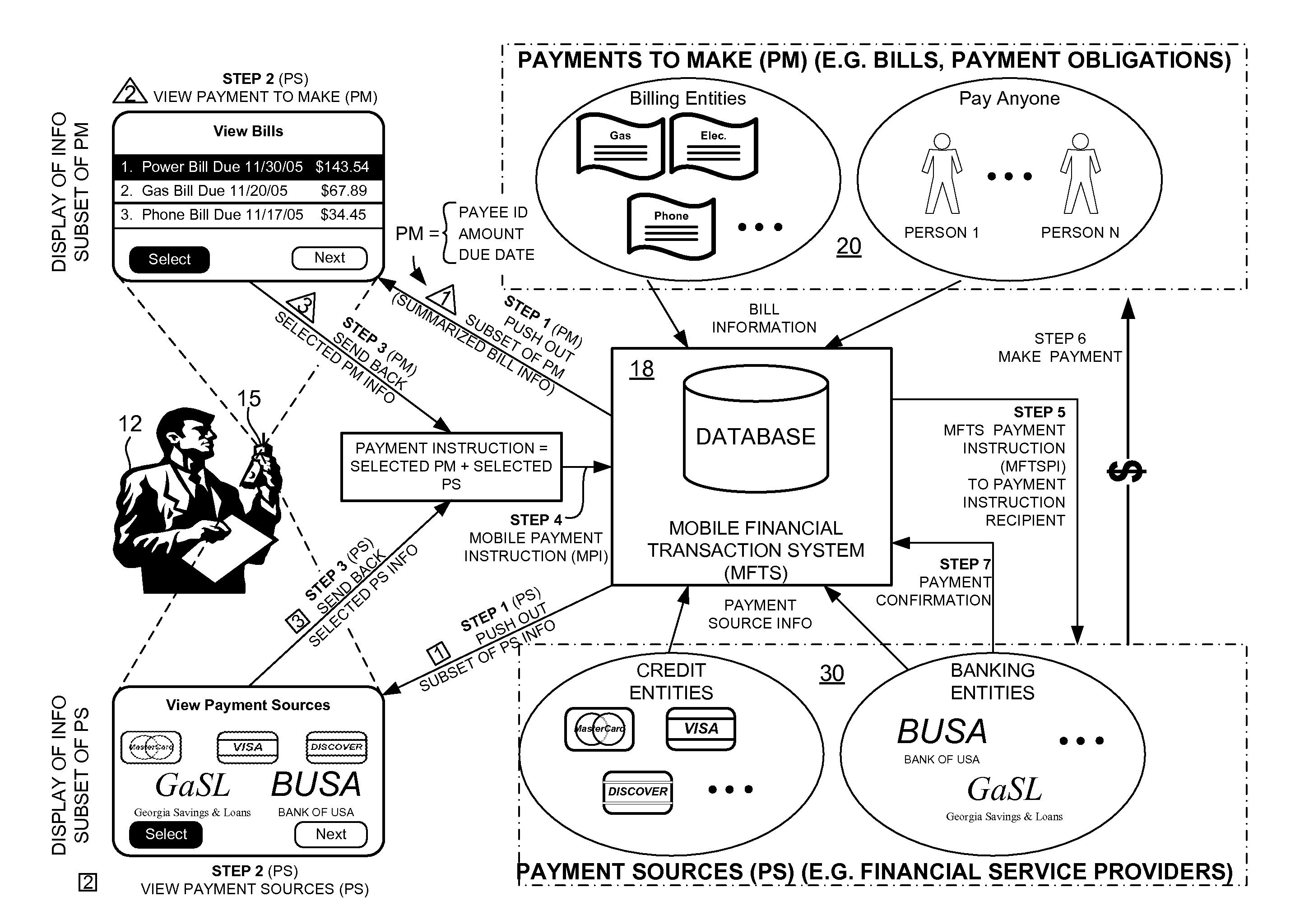

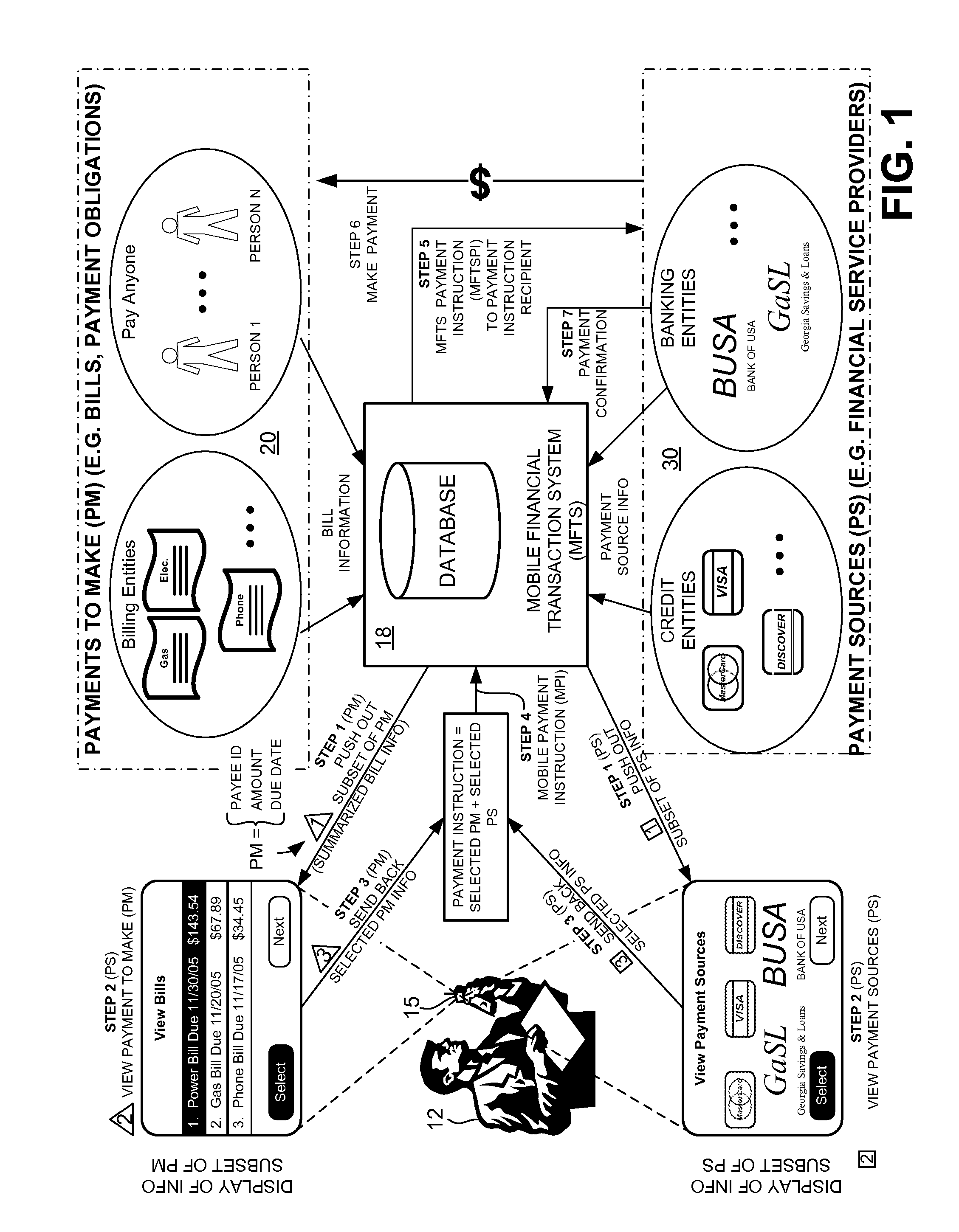

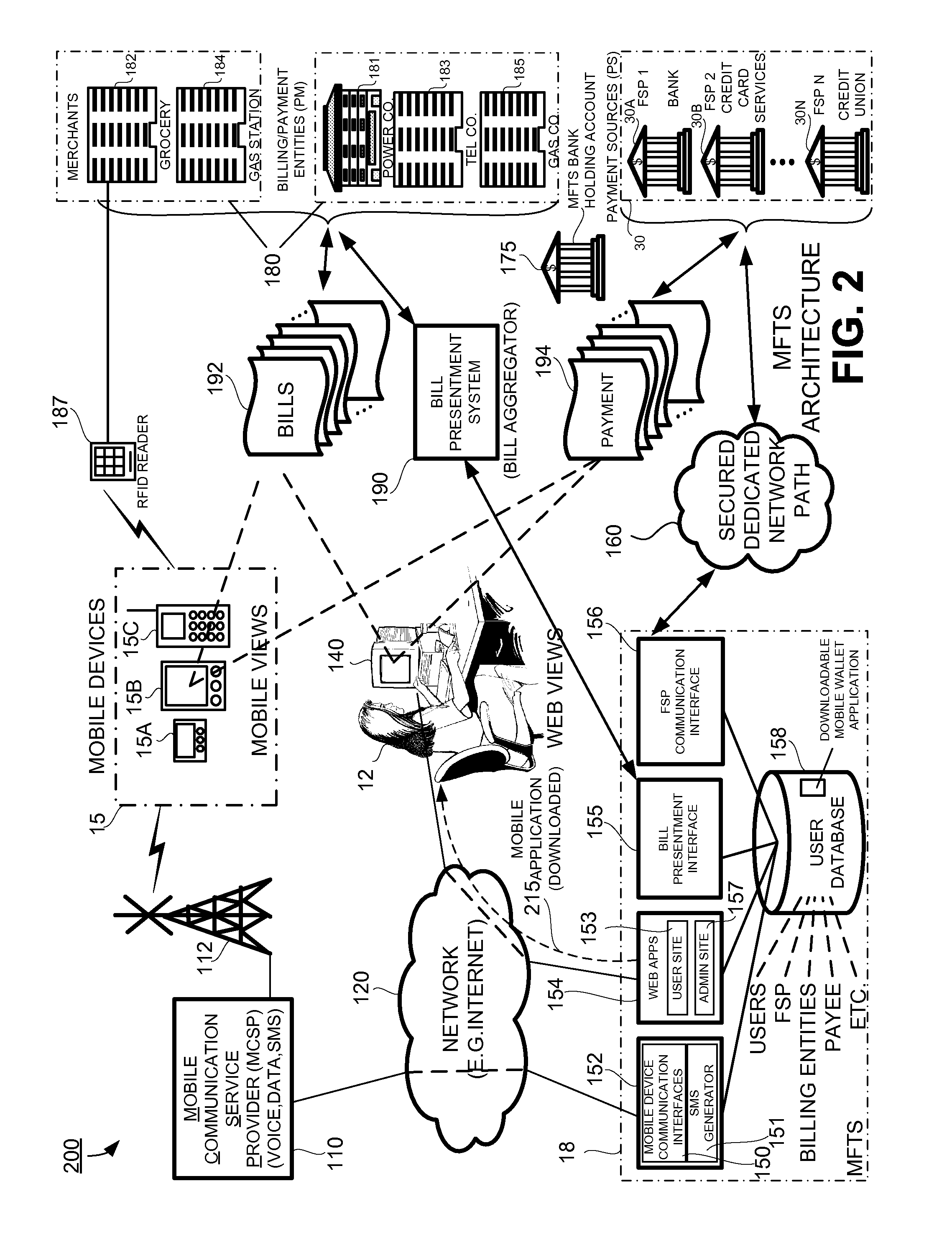

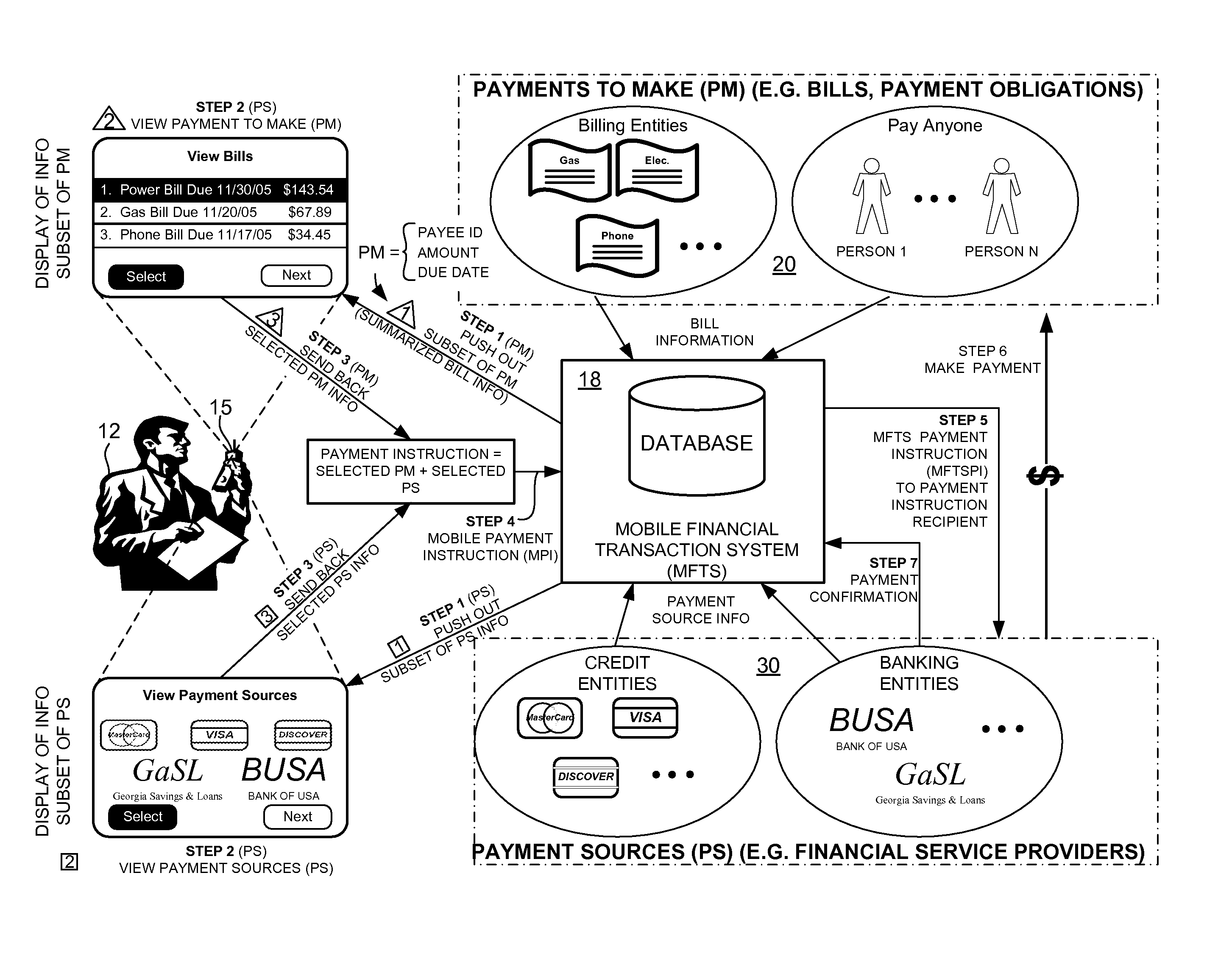

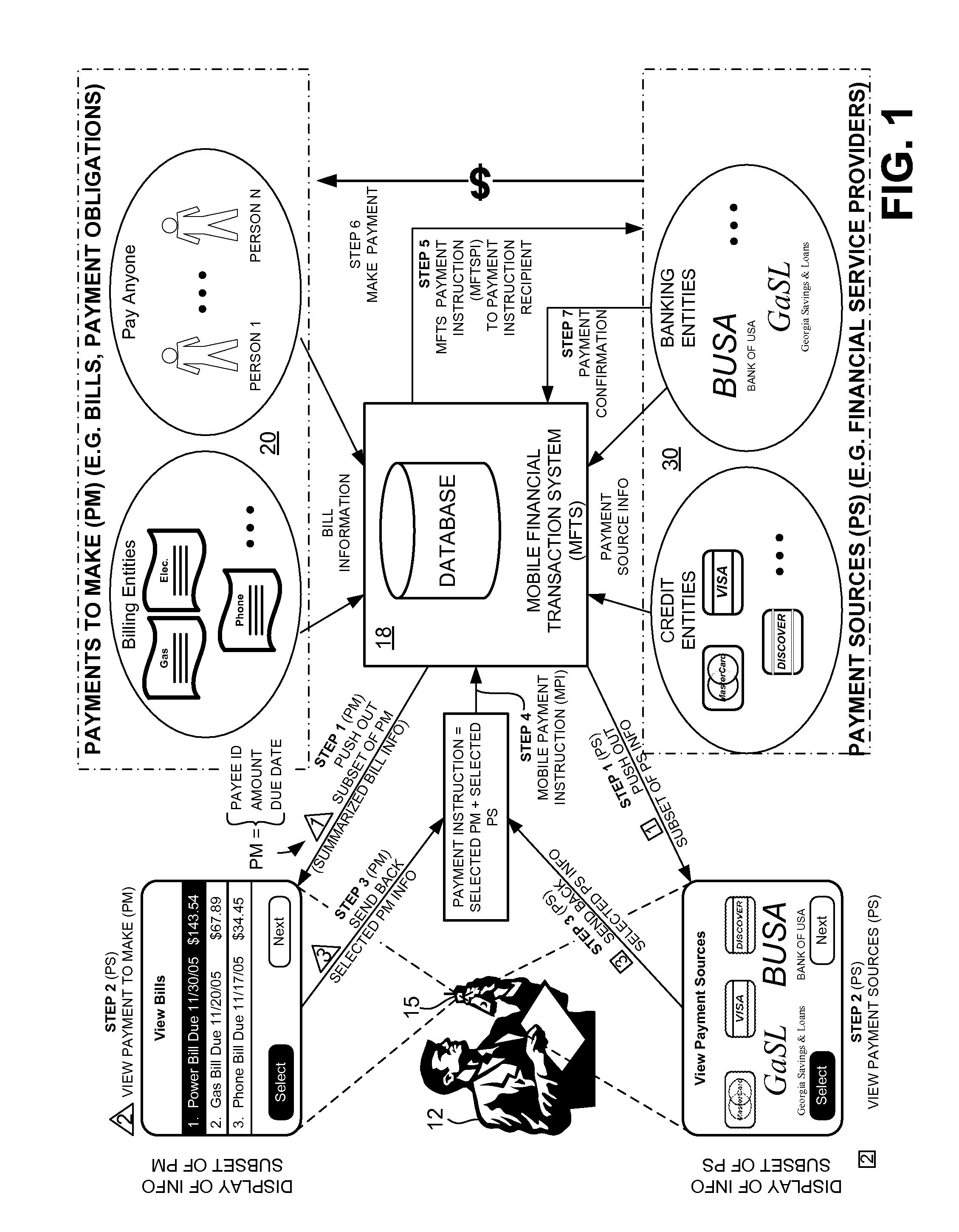

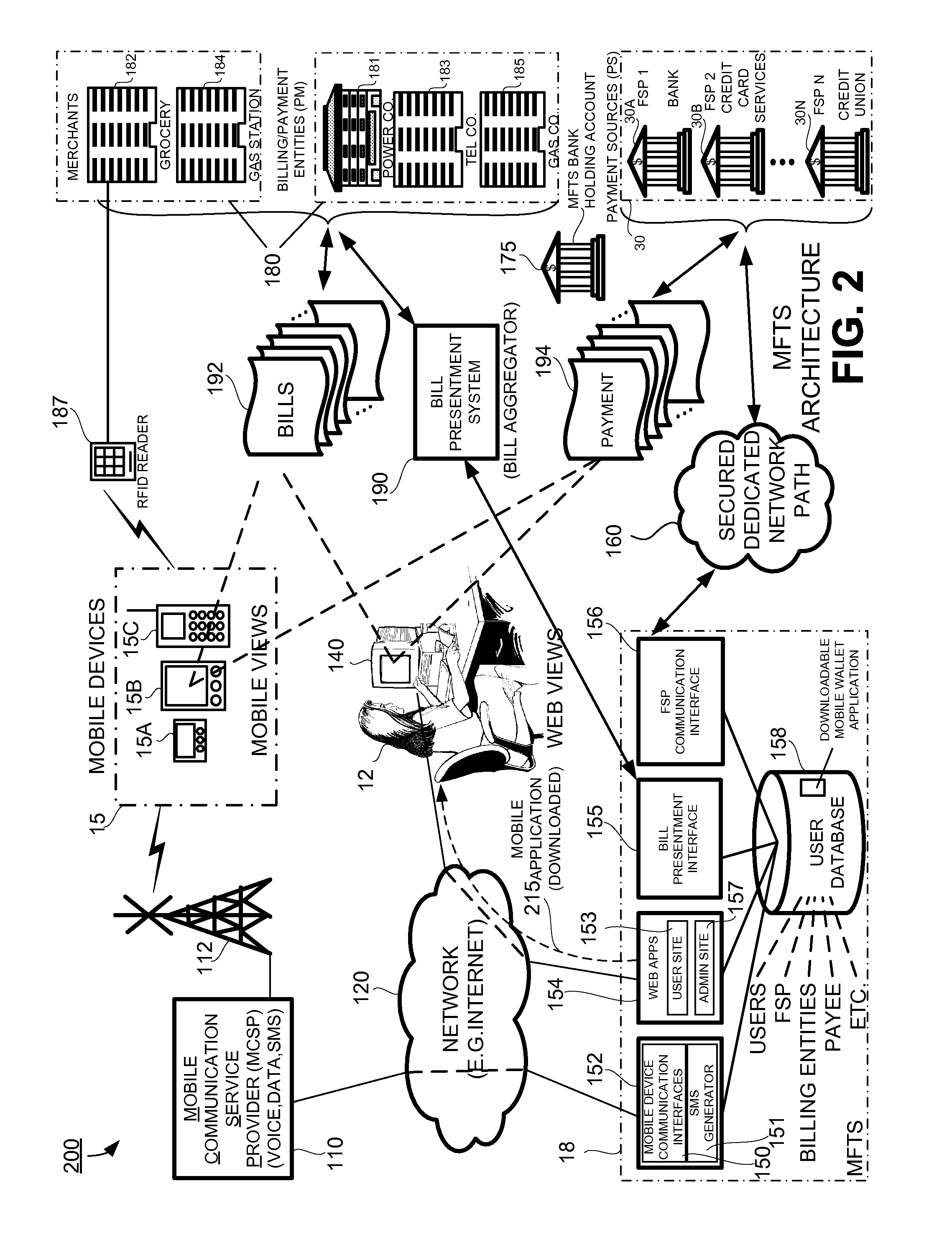

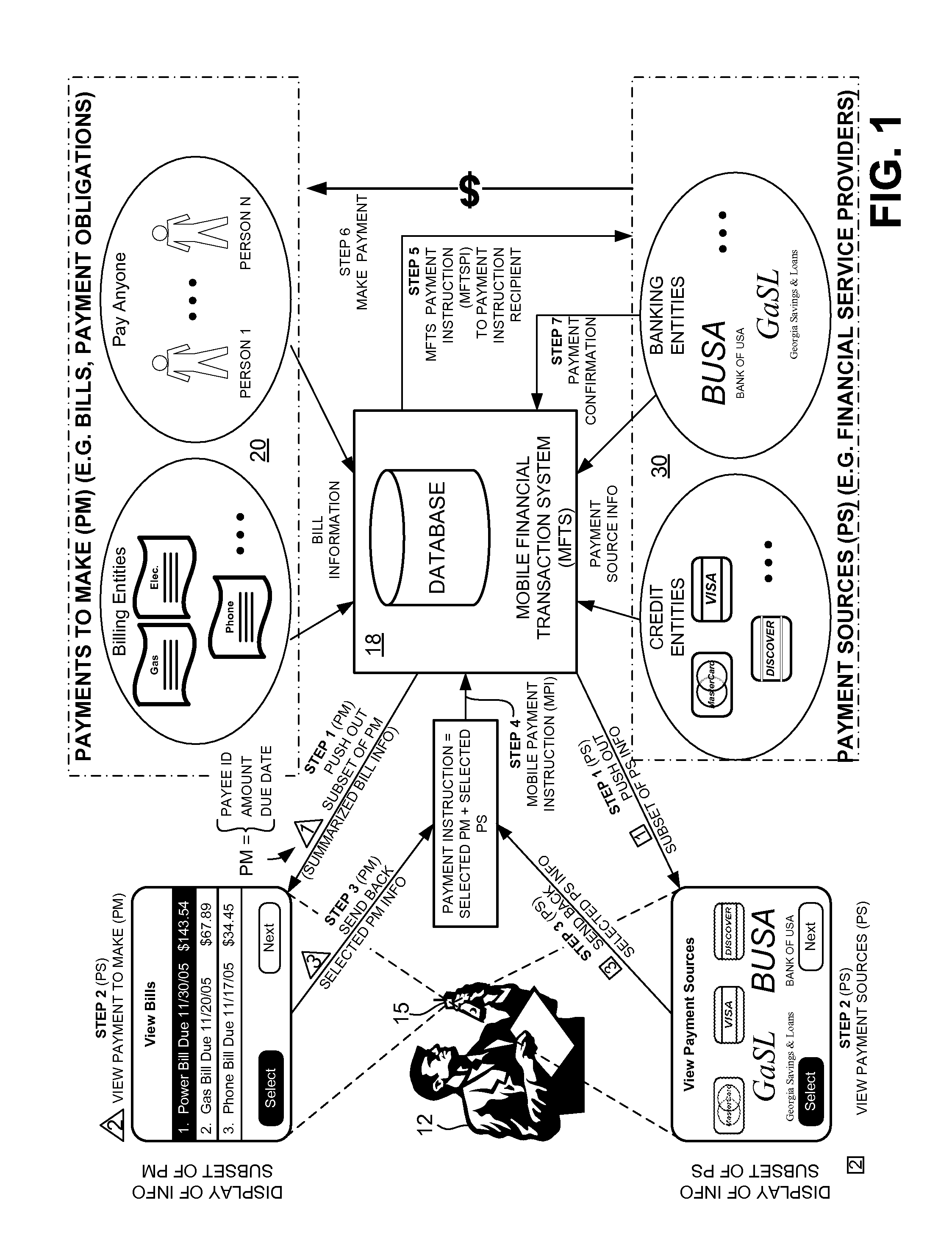

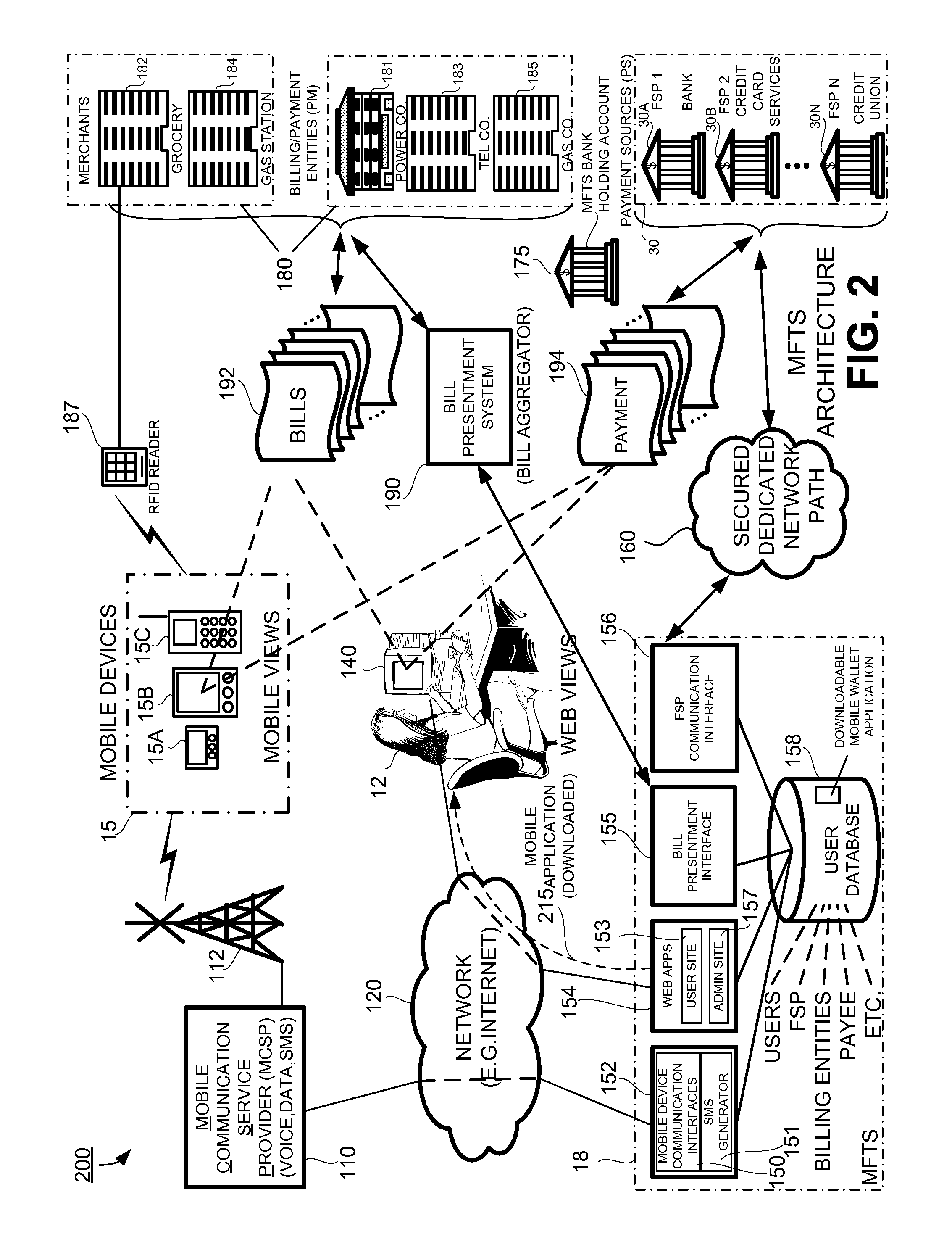

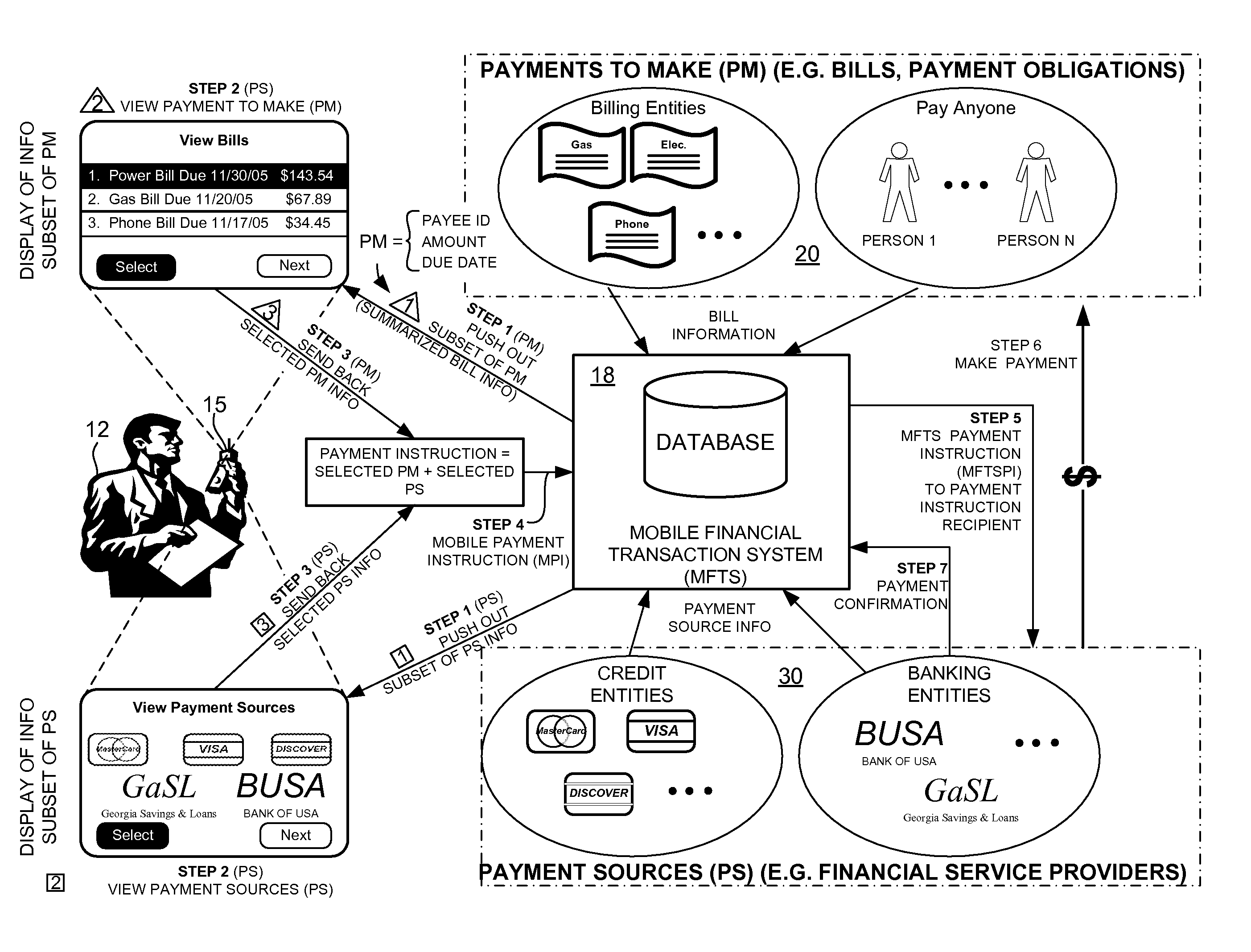

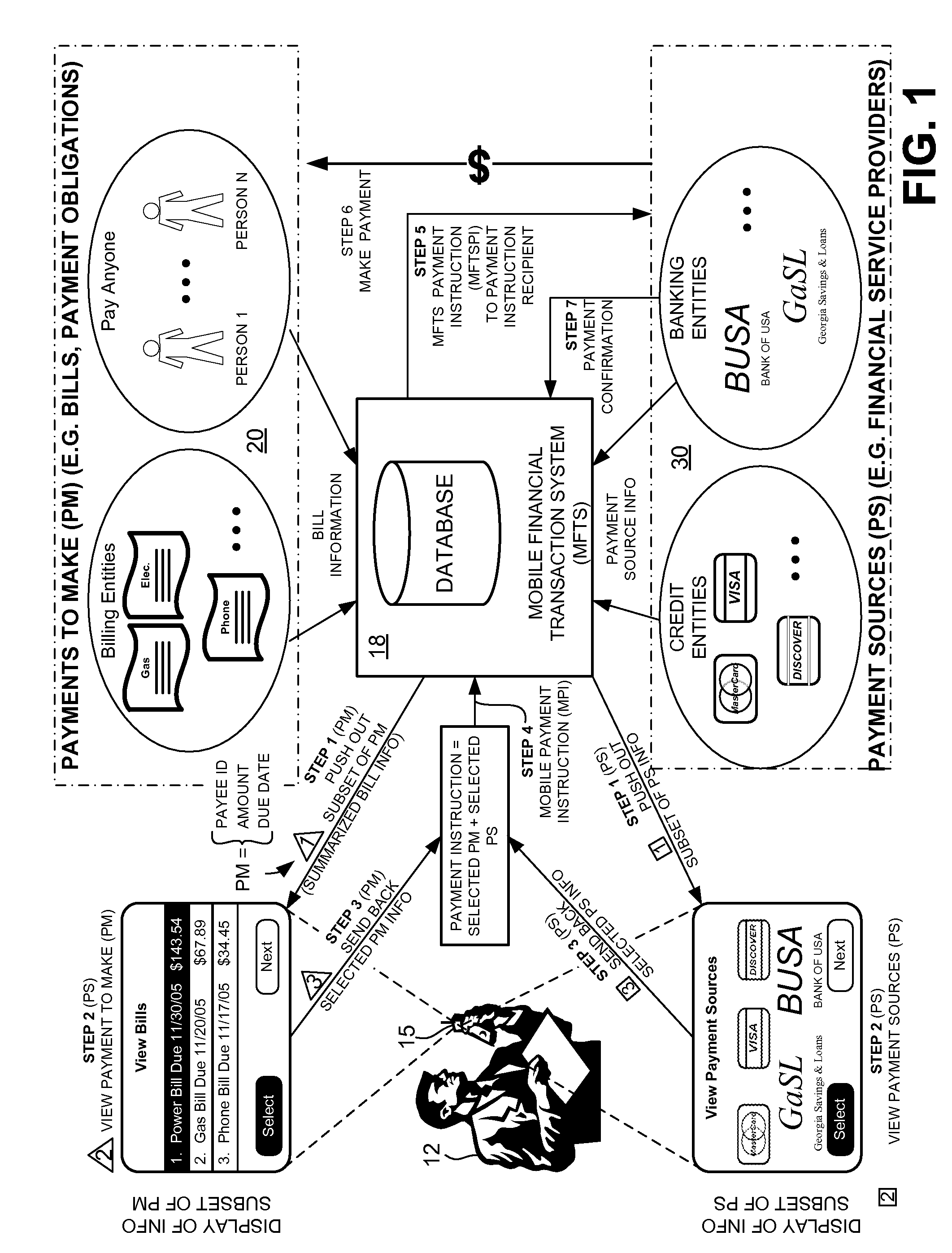

Methods and Systems For Managing Payment Sources in a Mobile Environment

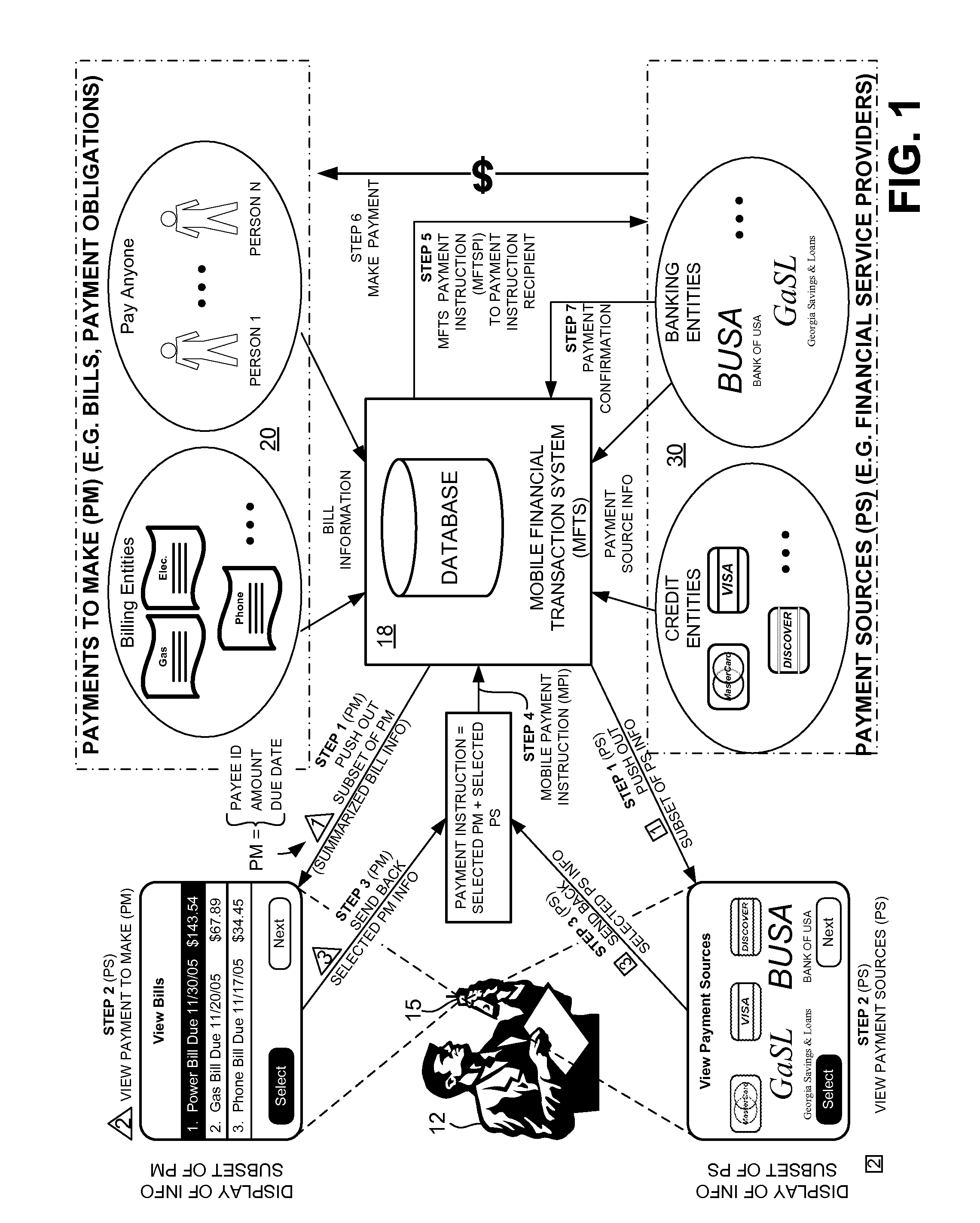

InactiveUS20080010215A1Unprecedented convenienceUnprecedented flexibilityFinanceTelephonic communicationElectronic communicationService provision

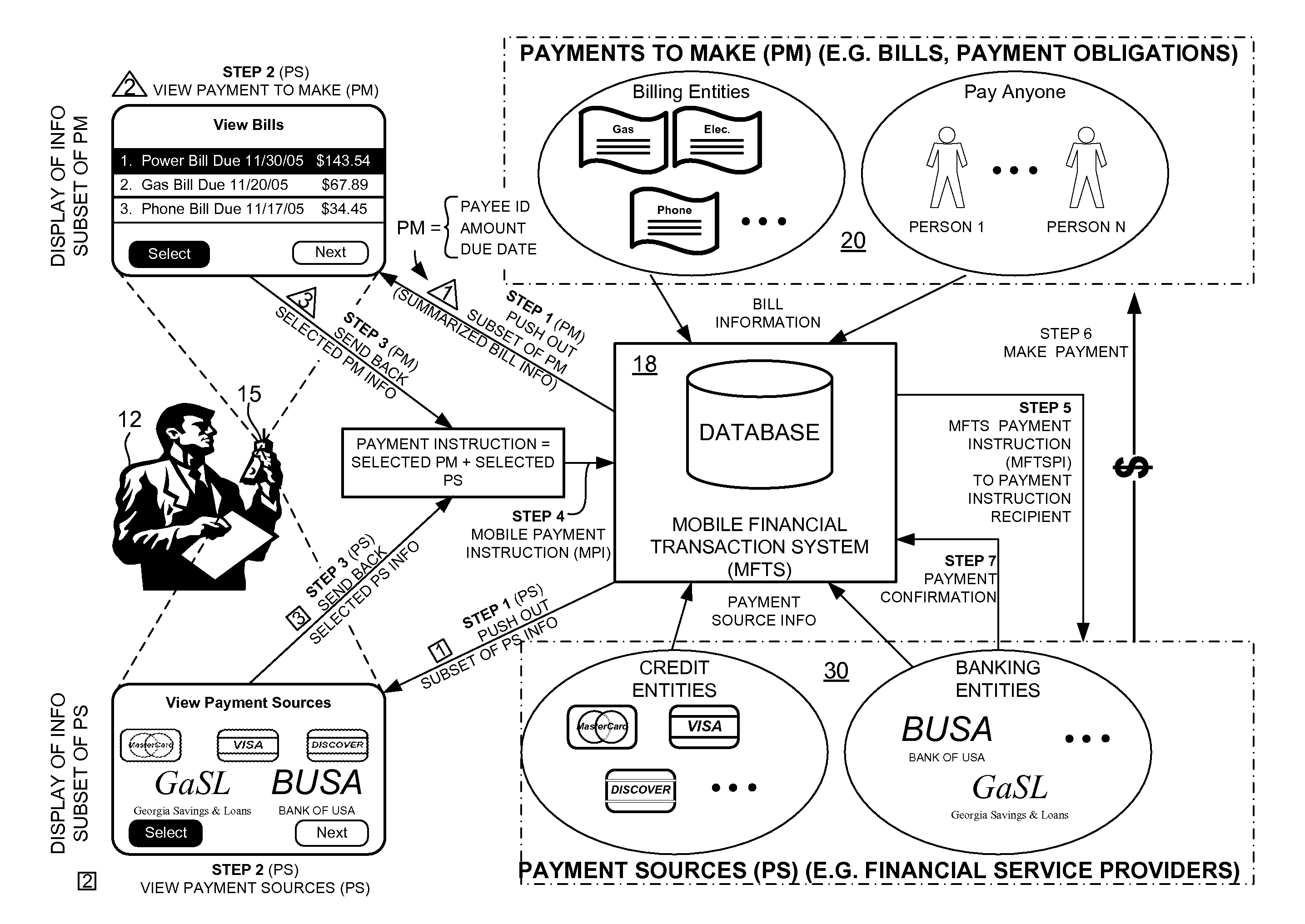

Methods and systems for selecting a payment source for use in making a mobile financial payment utilizing a mobile device such as a mobile telephone (cellphone) or wireless connected personal digital assistant (PDA). A mobile financial transaction system (MFTS) is coupled for electronic communications with one or more financial service providers with which the user maintains one or more accounts, and also for wireless communications with mobile devices. The mobile device displays information corresponding to accounts available to the user as a payment source for use in connection with making a payment using the mobile device. The user selects a payment source for making a payment. The mobile device generates a mobile payment instruction comprising information corresponding to the payment and a selected payment source. The mobile payment instruction is wirelessly communicated to the MFTS. The MFTS generates an MFTS payment instruction that includes an amount, information corresponding to the identified payee, and information indicating the selected payment source. The MFTS payment instruction is communicated to the payment instruction recipient, which effects the payment utilizing the selected payment source.

Owner:QUALCOMM INC

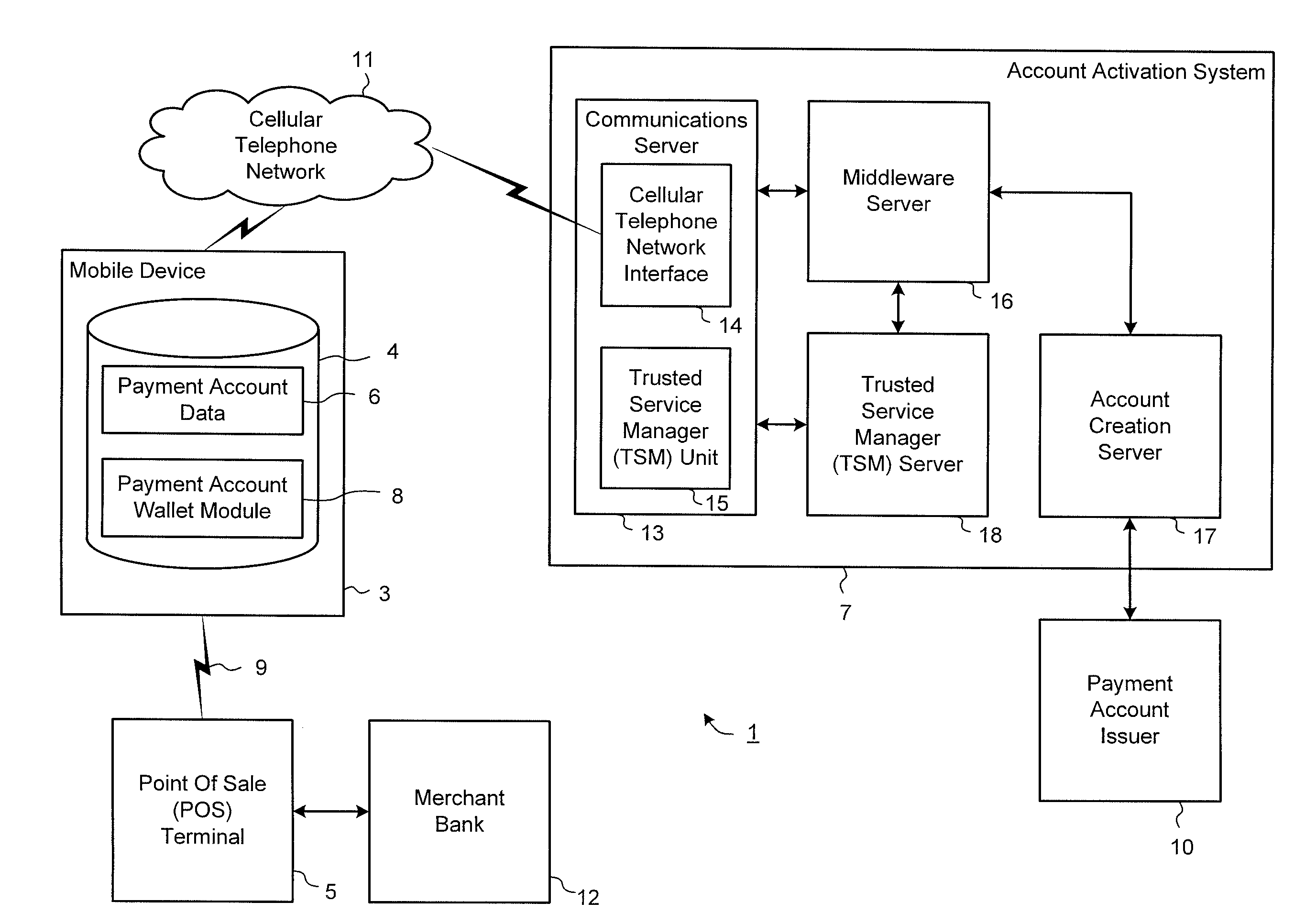

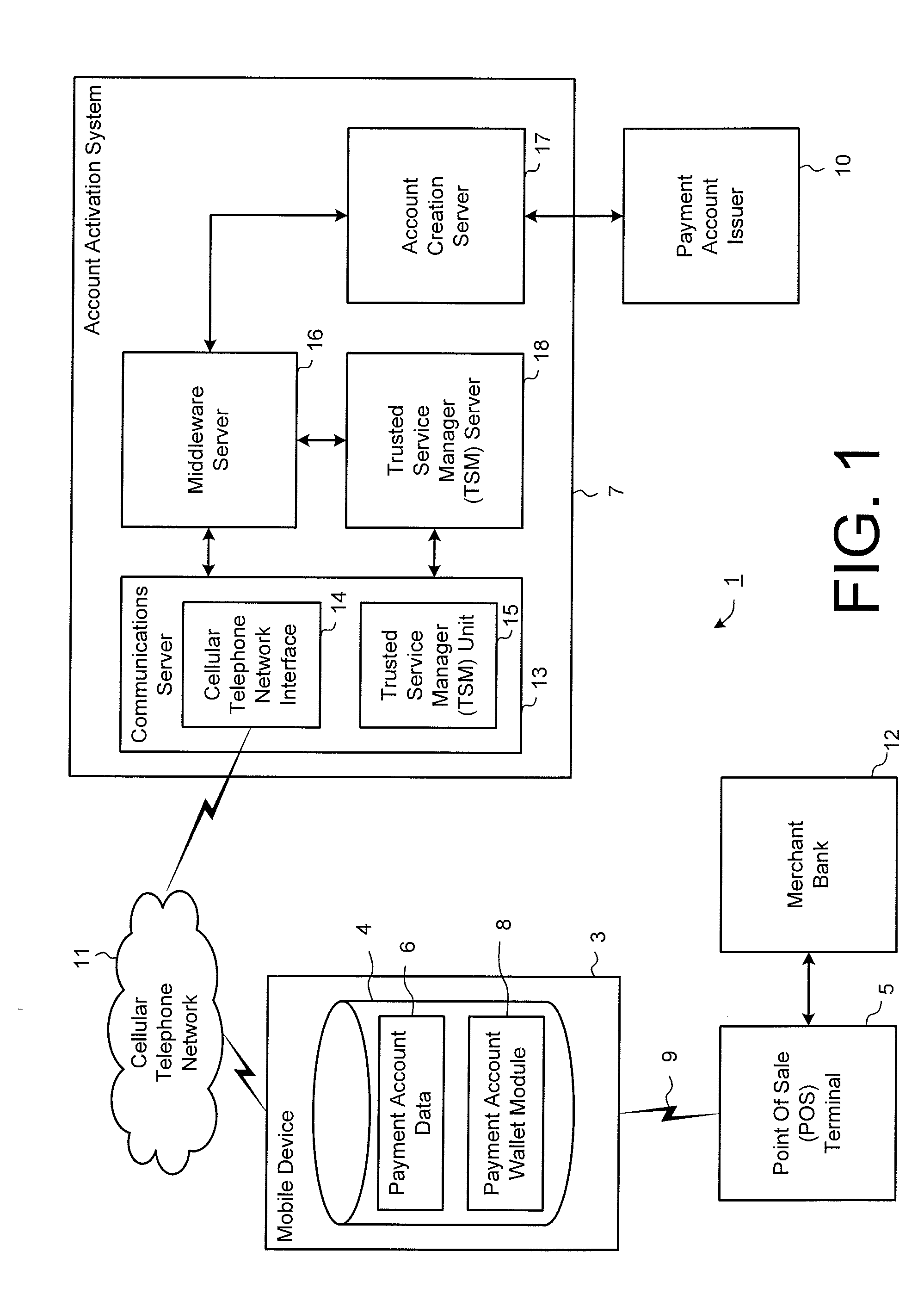

Secure account provisioning

ActiveUS20120078735A1Promote activationFinancePoint-of-sale network systemsComputer networkUser authentication

A mobile payment system and method are described that facilitates the secure and real time user authentication and activation of a mobile payment account for a user portable electronic device over a communications network.

Owner:BARCLAYS EXECUTION SERVICES LTD

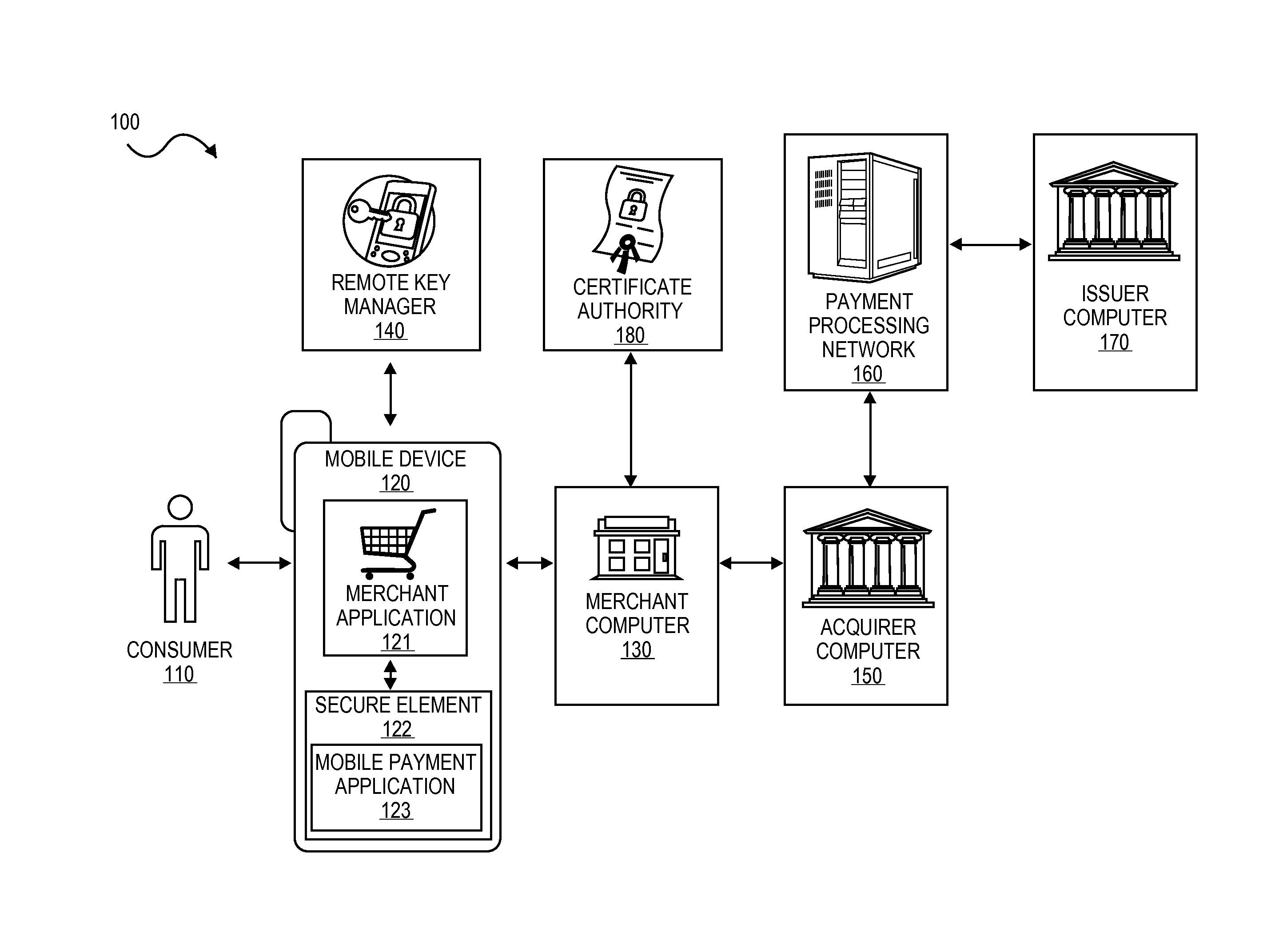

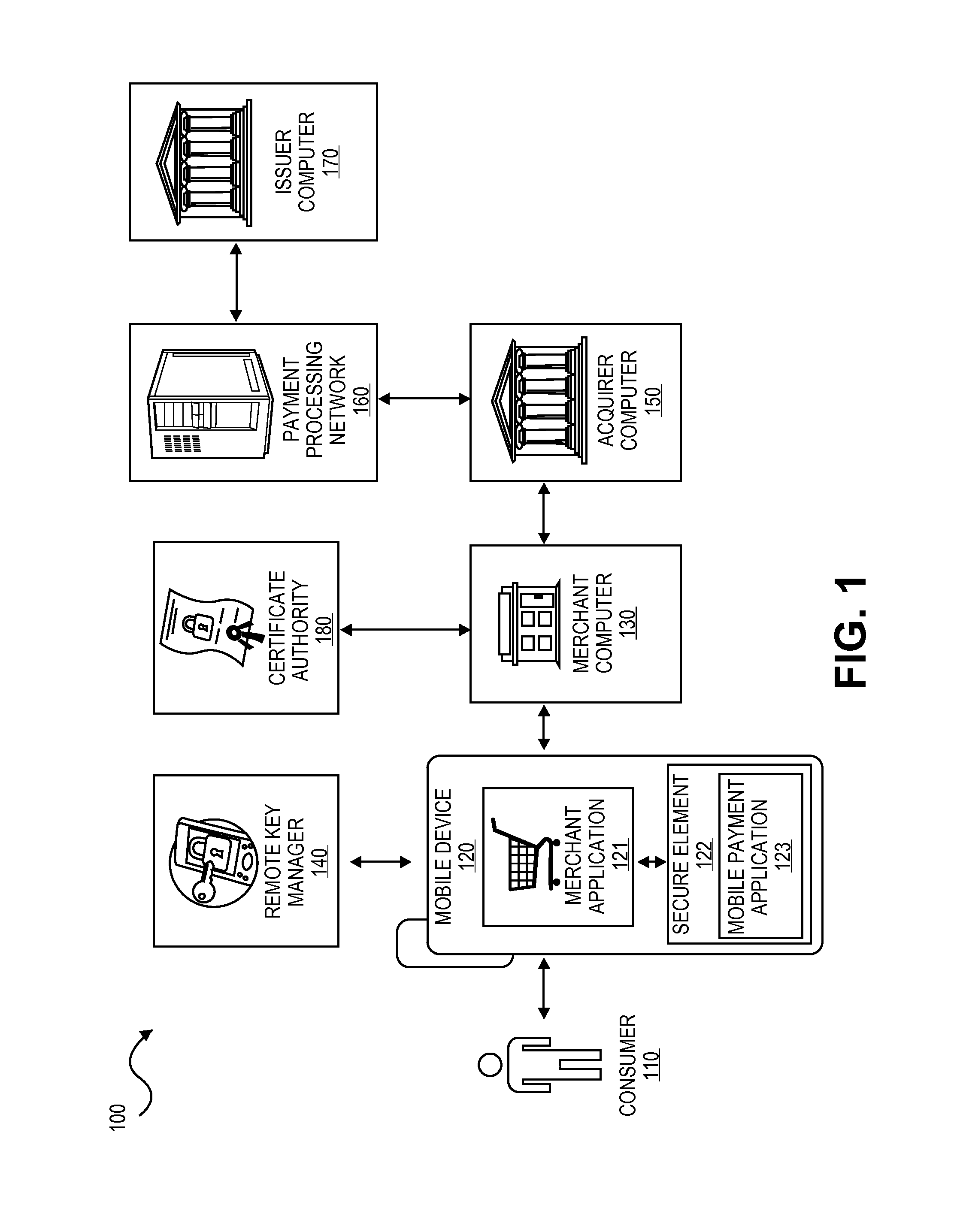

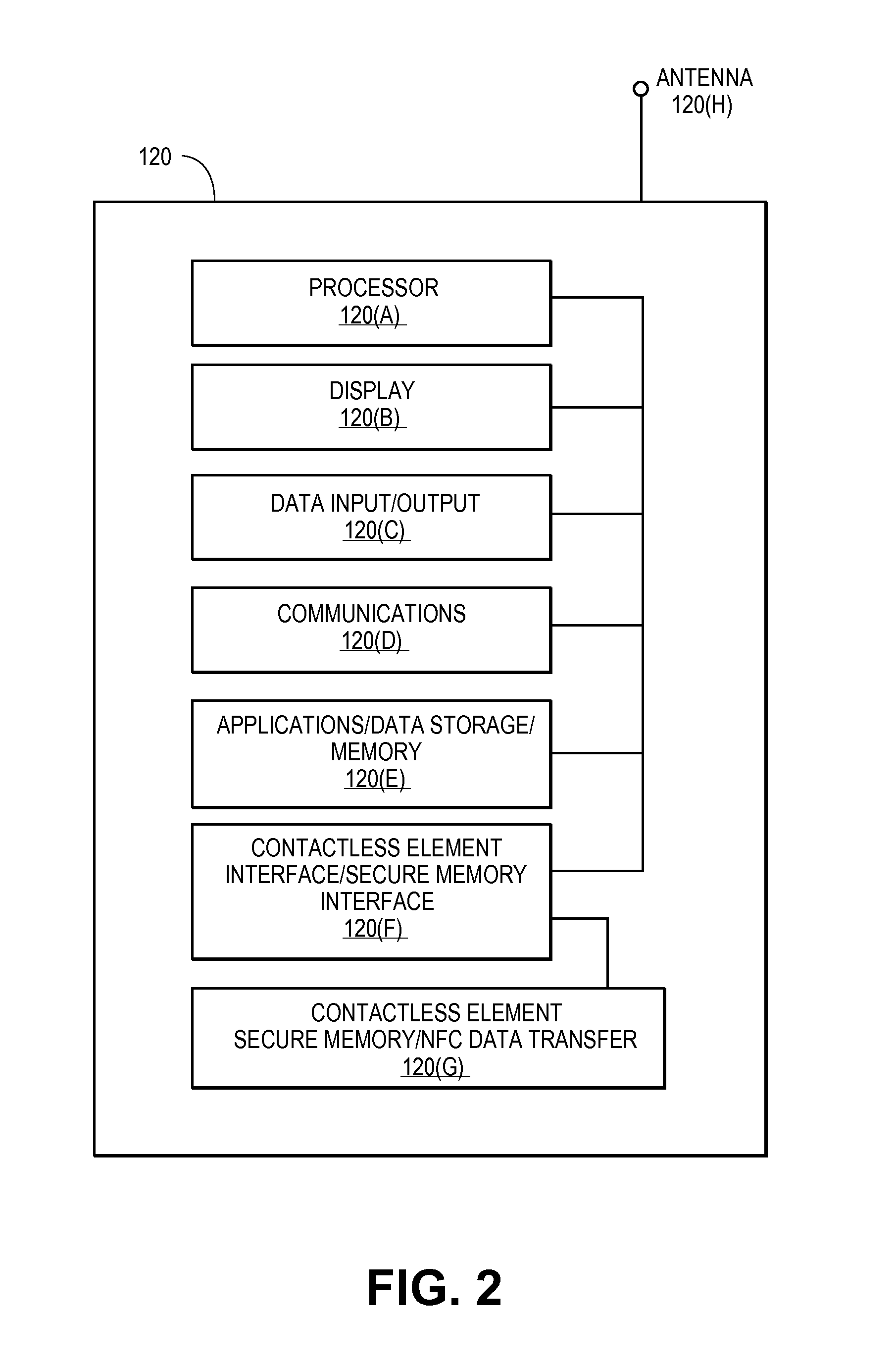

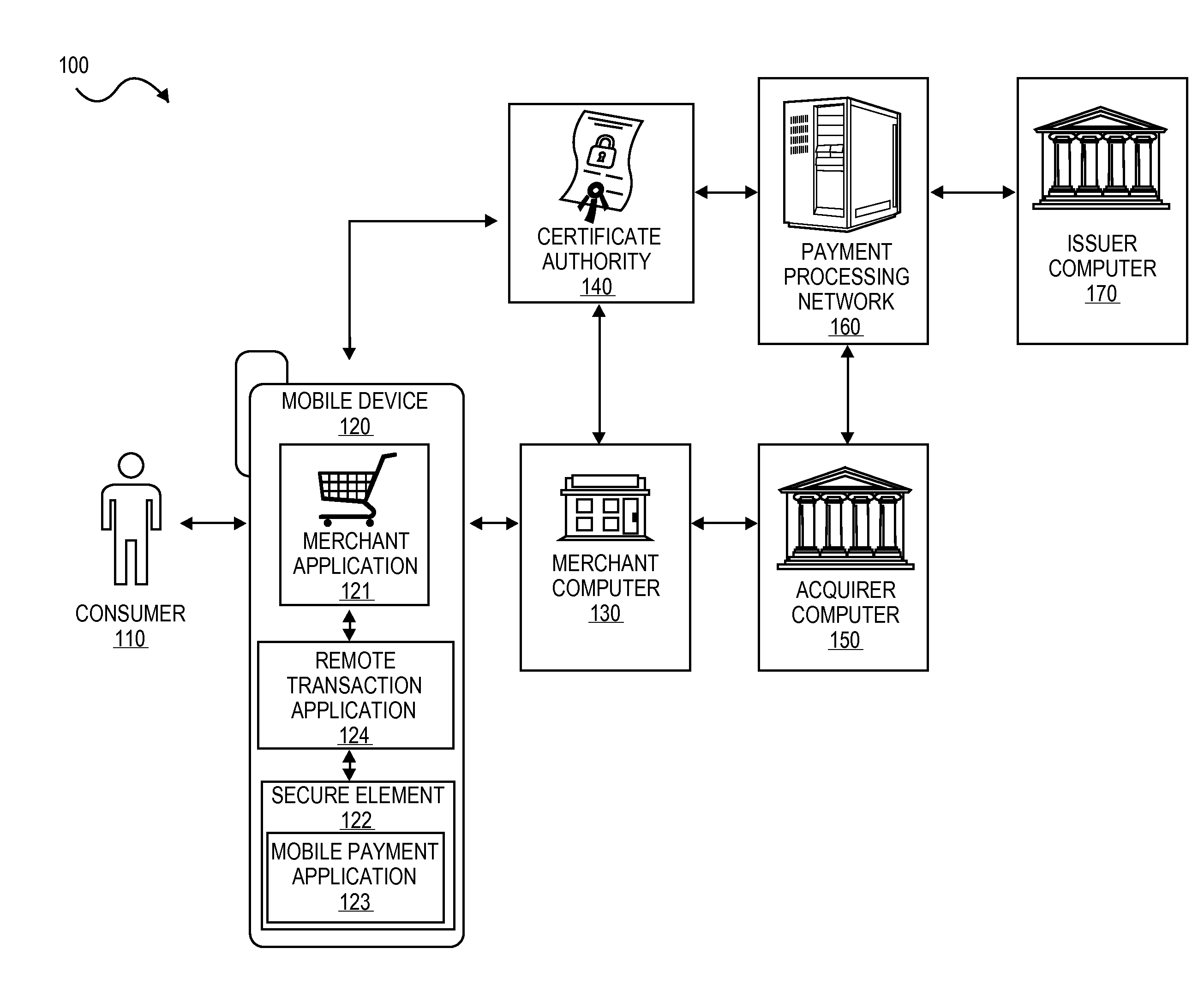

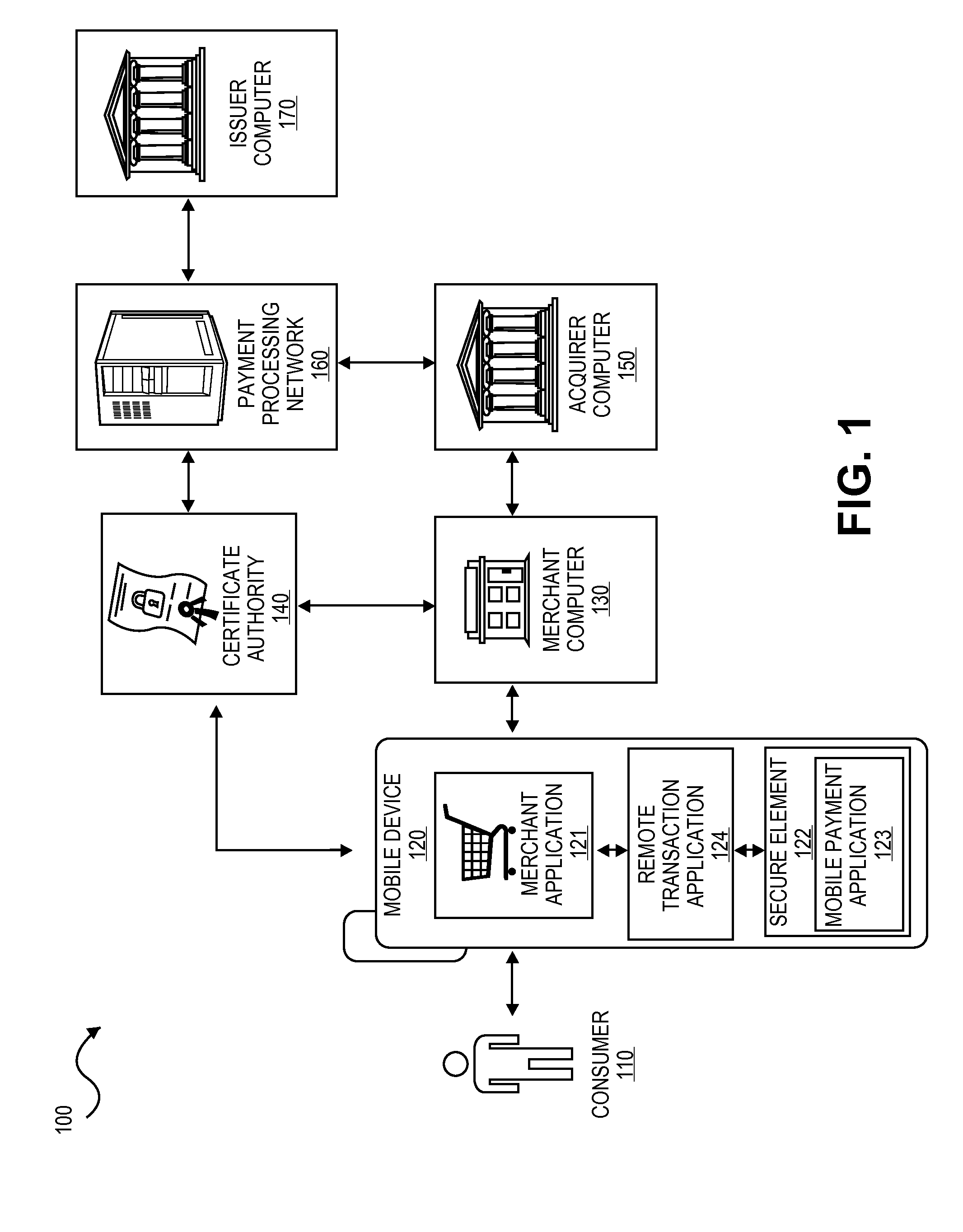

Secure remote payment transaction processing

ActiveUS20150019443A1Improve security levelImprove securityProtocol authorisationThird partyPayment transaction

Embodiments of the present invention are directed to methods, apparatuses, computer readable media and systems for securely processing remote transactions. One embodiment of the invention is directed to a method of processing a remote transaction initiated by a mobile device comprising a server computer receiving a payment request including encrypted payment information. The encrypted payment information being generated by a mobile payment application of the mobile device and being encrypted using a third party key. The method further comprises decrypting the encrypted payment information using the third party key, determining a transaction processor public key associated with the payment information, and re-encrypting the payment information using the transaction processor public key. The method further comprises sending a payment response including the re-encrypted payment information to a transaction processor. The transaction processor decrypts the re-encrypted payment information using a transaction processor private key and initiates a payment transaction.

Owner:VISA INT SERVICE ASSOC

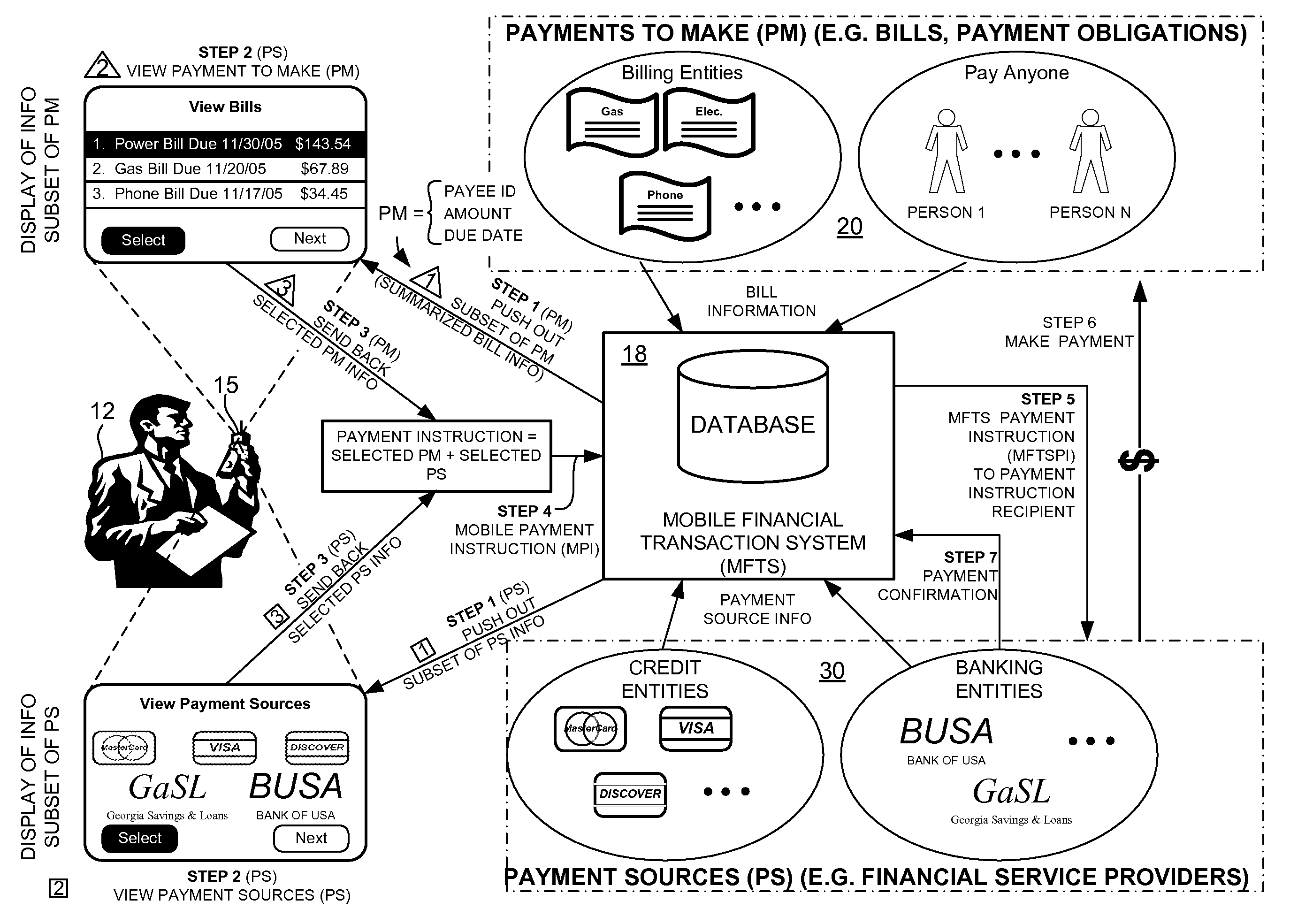

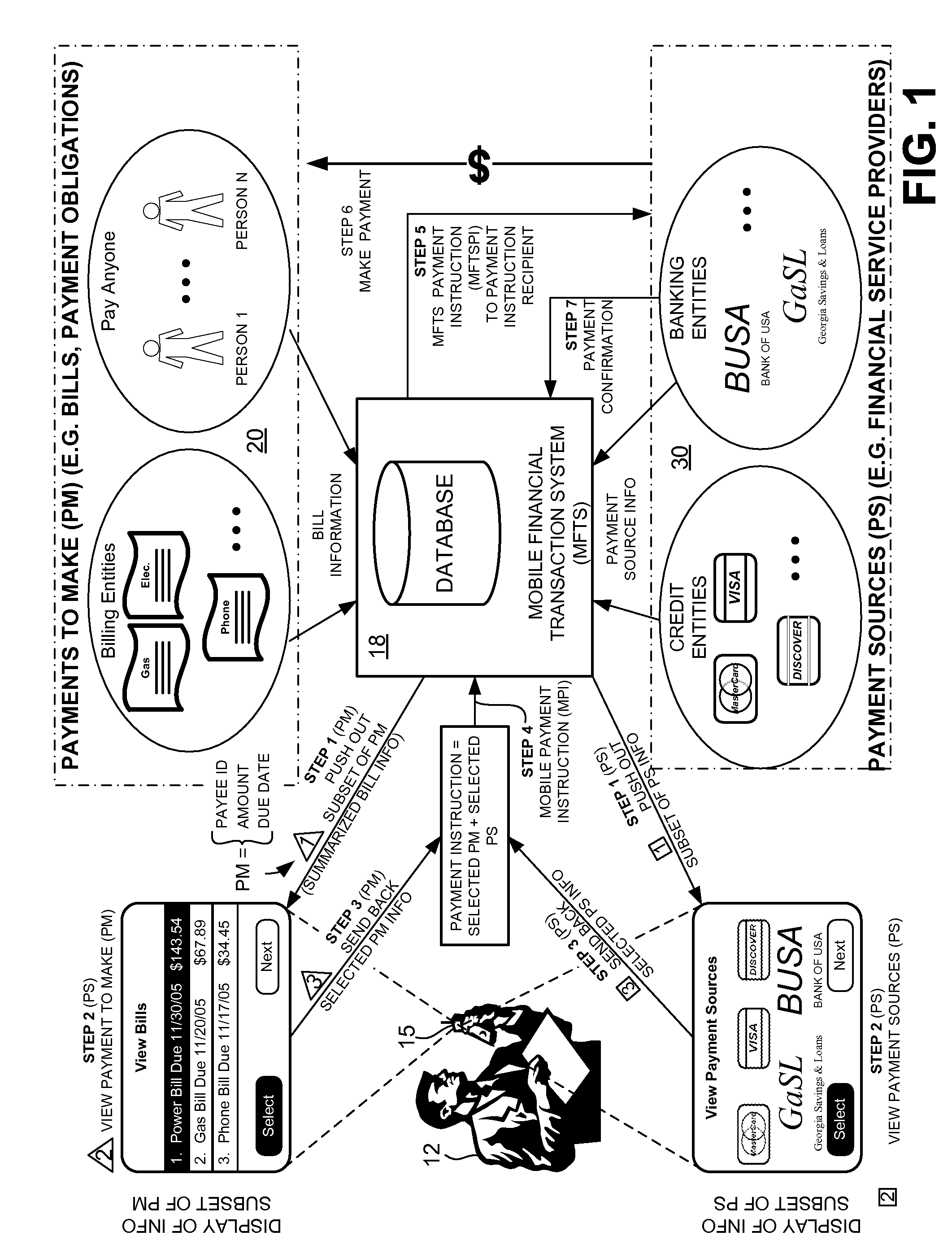

Methods and Systems For Payment Transactions in a Mobile Environment

ActiveUS20080010190A1Unprecedented convenienceUnprecedented flexibilityFinancePayment architecturePayment transactionFinancial transaction

Methods and systems for conducting financial transactions in a mobile environment utilizing a mobile device such as a mobile telephone or wireless connected personal digital assistant (PDA) that communicates with a mobile financial transaction system (MFTS) that stores user and transaction information. The MFTS receives information on behalf of a mobile device user corresponding to bills to pay or other payments to make. The MFTS also receives information corresponding to payment sources available for use in making payments. Selected payments information and payment source information are communicated to the mobile user via a wireless network and displayed for user selection. The user selects a payment to make and a payment source. A mobile payment instruction is generated and communicated to the MFTS. The MFTS instructs a payment instruction recipient to make a payment to an identified payee. Real-time updated account and payment balances are provided to the user's mobile device.

Owner:QUALCOMM INC

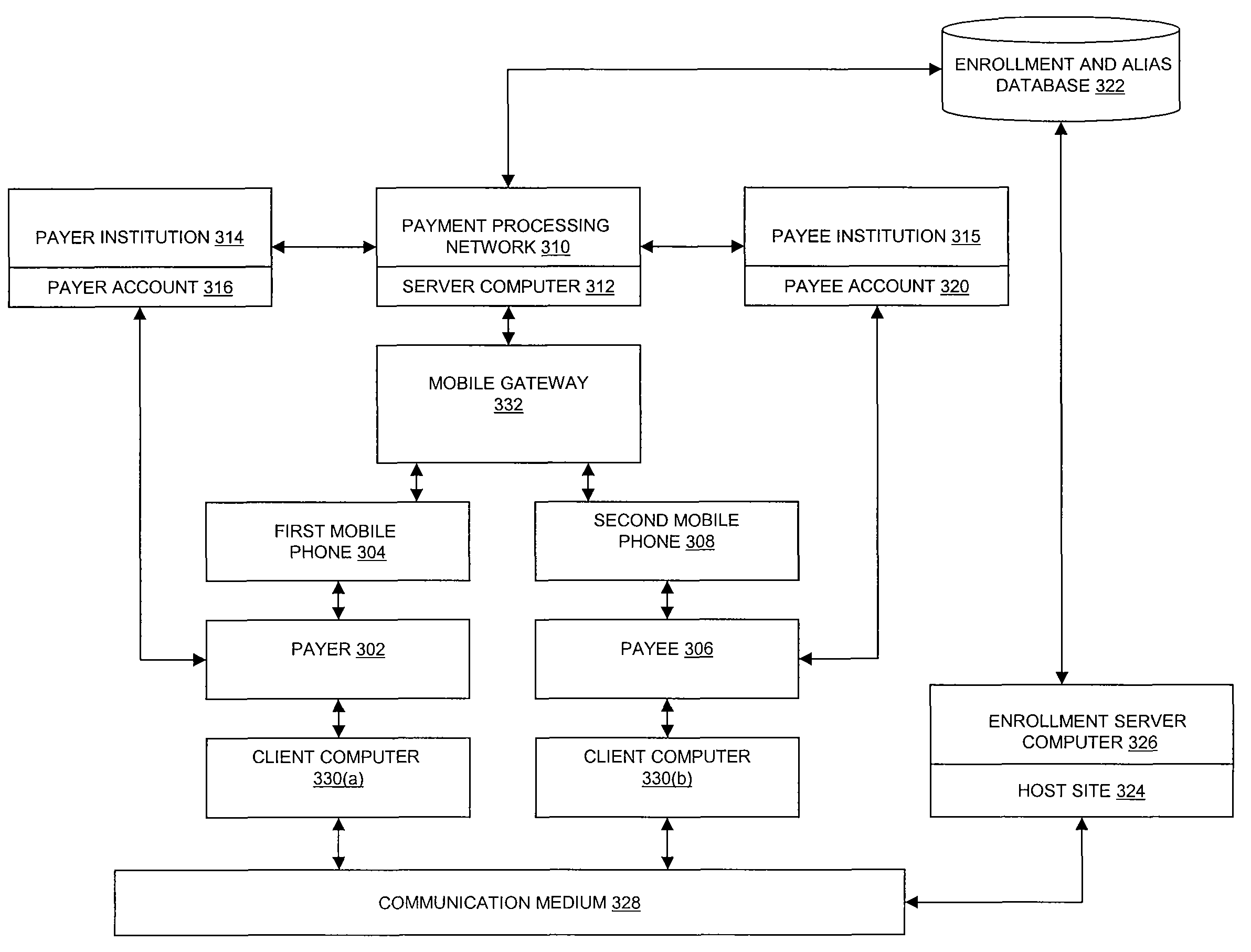

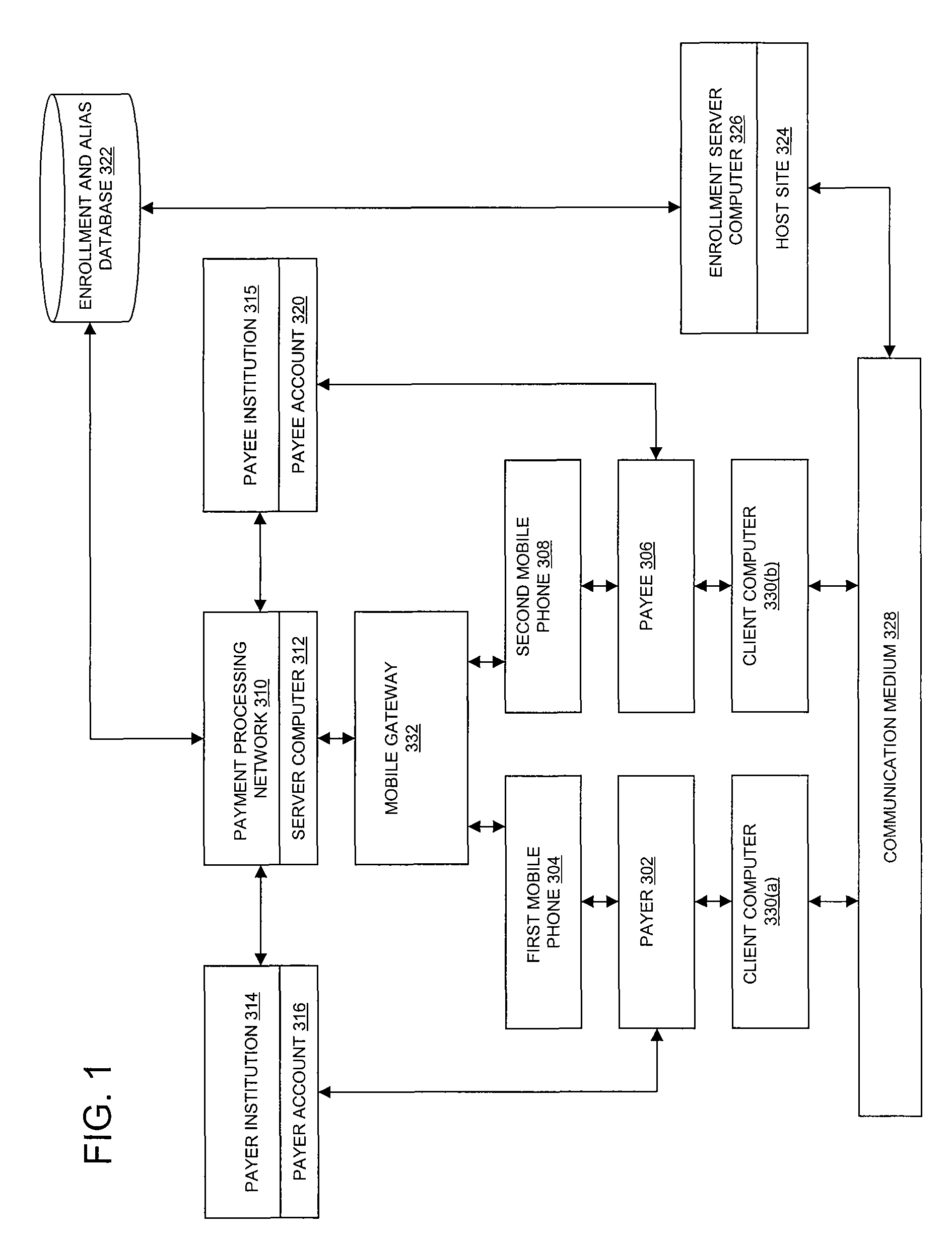

Mobile payment system and method using alias

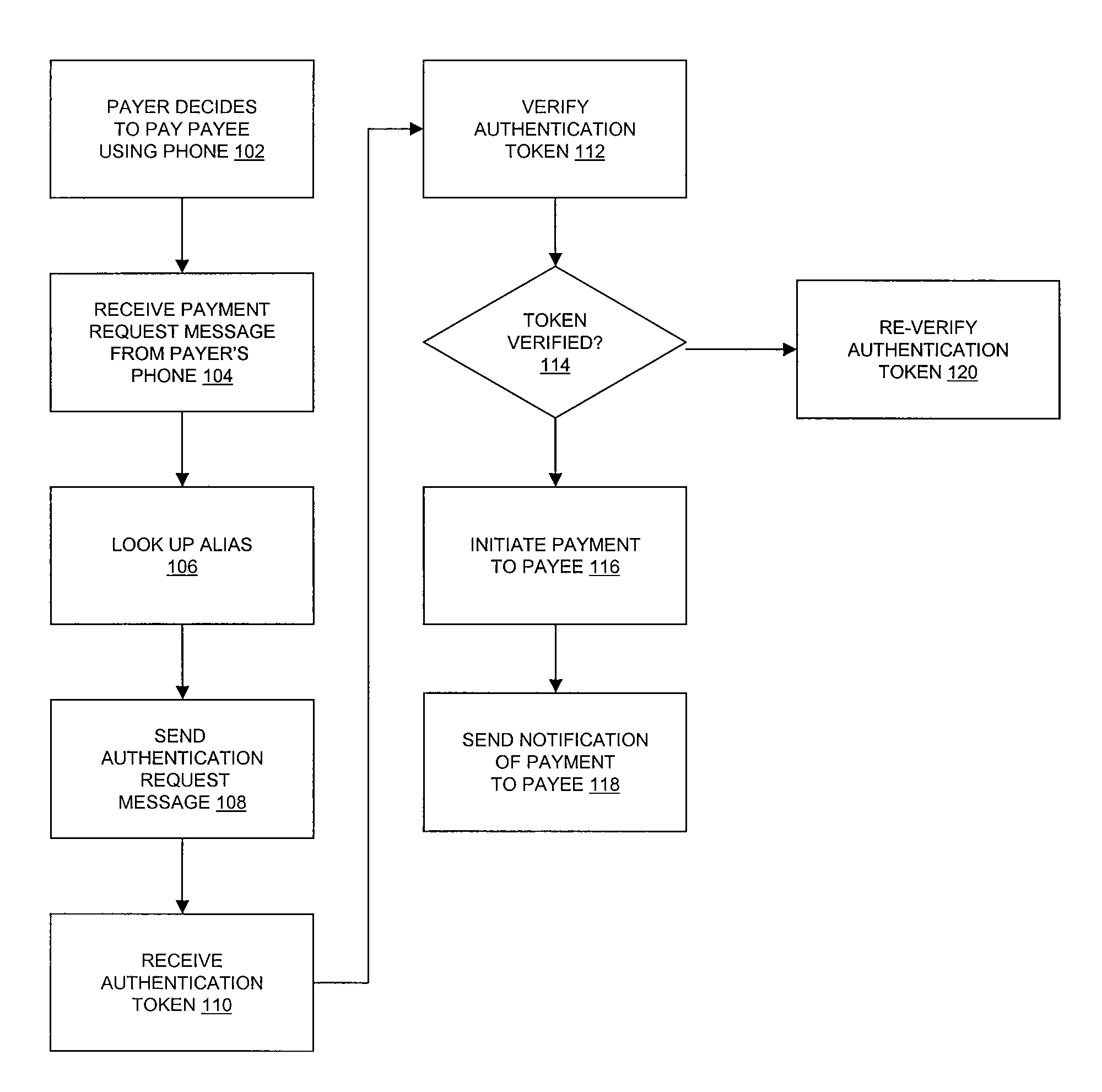

Methods and systems are disclosed for allowing financial transactions to be conducted using mobile phones. A payer initiates a transaction by sending a payment request message from a mobile phone which specifies the payee and amount to be paid. Payees are identified by unique aliases, which are maintained in a database. Methods for assembling the enrollment and alias database are included.

Owner:VISA USA INC (US)

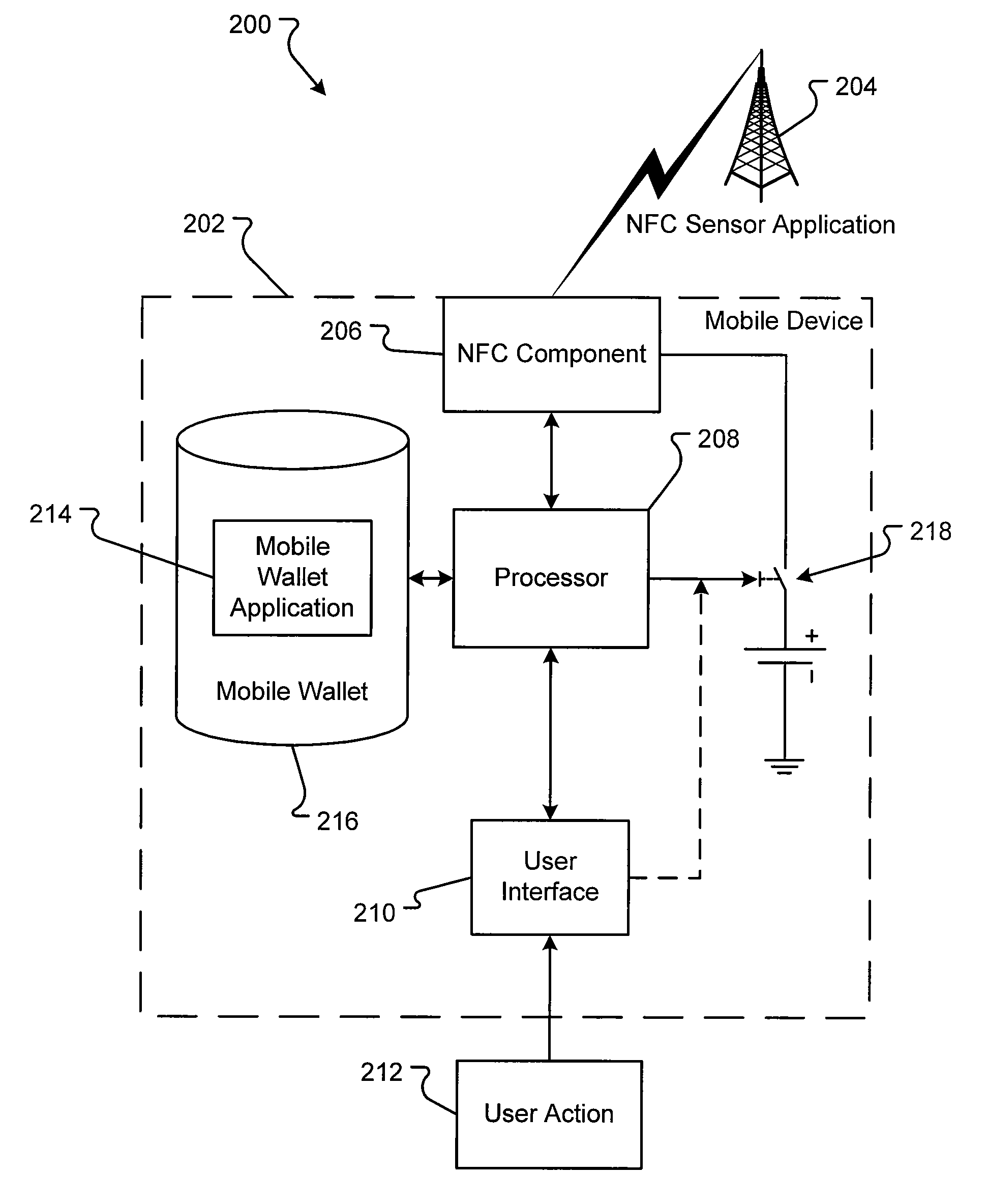

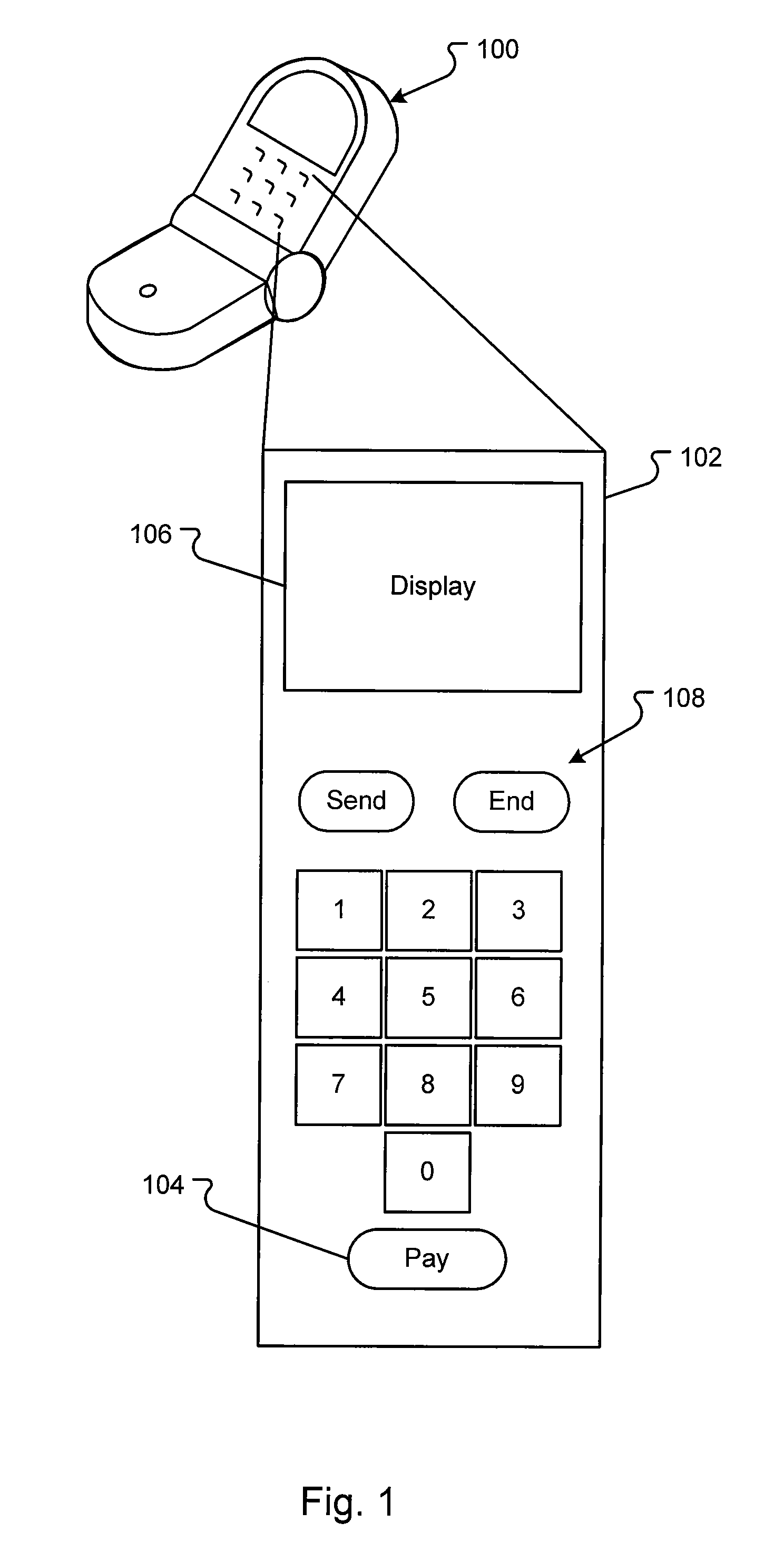

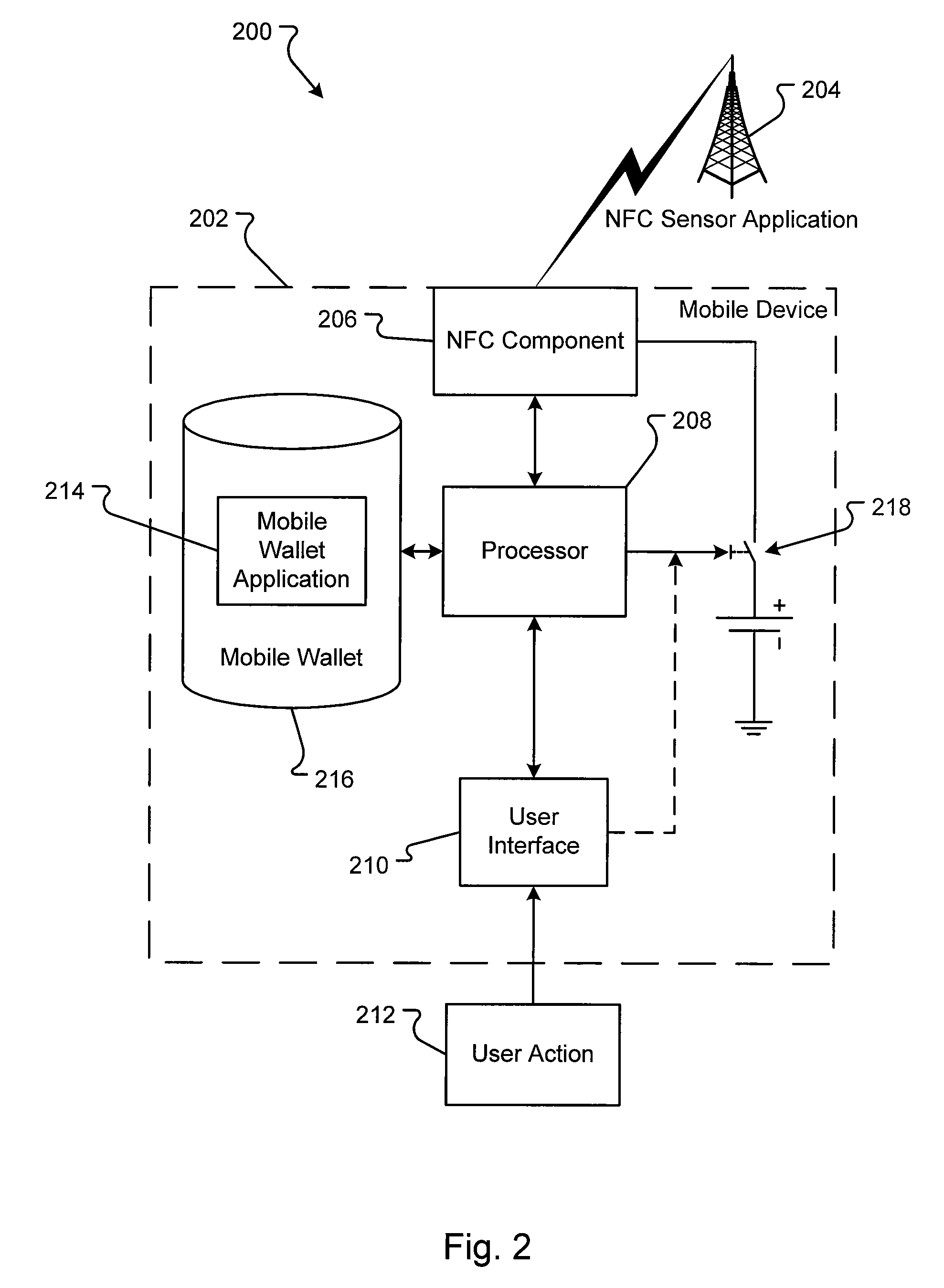

Mobile payment adoption by adding a dedicated payment button to mobile device form factors

Embodiments presented herein generally relate to a novel mobile device containing a near field communication (NFC) component. In embodiments, the mobile device includes a payment user interface device. The payment user interface device may be a button on a keypad or may be an icon on a user interface. In embodiments, only after activating, by depressing or selecting, the payment user interface device can allow a user to use the NFC component. In embodiments, the NFC component is powered off until the activation of the payment user interface device.

Owner:FIRST DATA

Methods and Systems For Making a Payment Via a Paper Check in a Mobile Environment

InactiveUS20080010204A1Unprecedented convenienceUnprecedented flexibilityAcutation objectsFinanceChequeFinancial transaction

Methods and systems for making a financial payment to a payee via a paper check utilizing a mobile device such as a mobile telephone (cellphone) or wireless connected personal digital assistant (PDA). The mobile device communicates wirelessly with a mobile financial transaction system (MFTS) that stores user information and transaction information. A user enters information via the mobile device identifying a payee and indicating a paper check payment method. The mobile device generates a mobile payment instruction that includes information corresponding to the identified payee and indicating a paper check payment method. The mobile payment instruction is wirelessly communicated to the MFTS. The MFTS generates an MFTS payment instruction to a payment instruction recipient that can issue a paper check. The MFTS communicates the MFTS payment instruction to the payment instruction recipient, which arranges for payment to the identified payee by printing and mailing of a paper check to the payee.

Owner:QUALCOMM INC

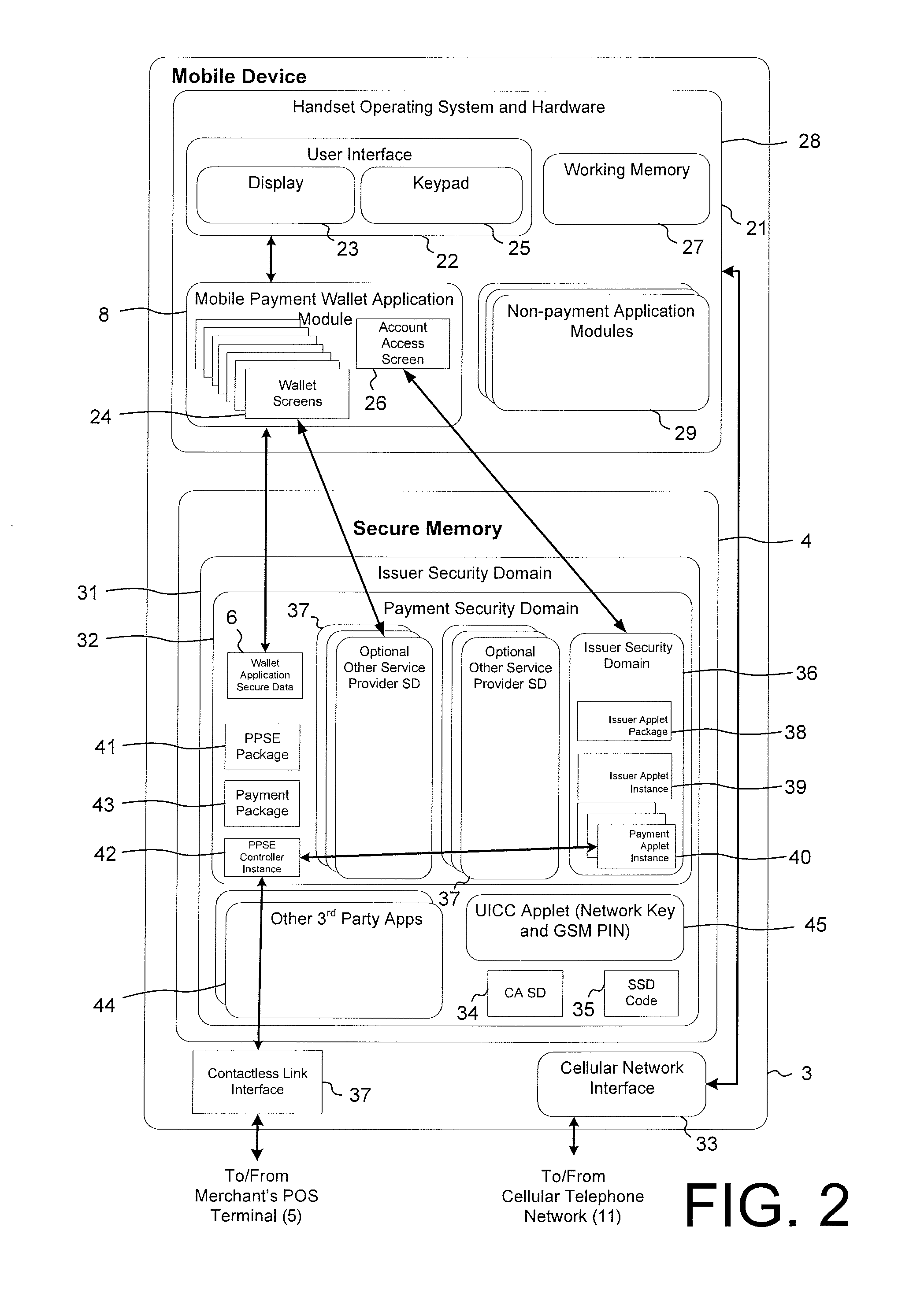

Secure Remote Payment Transaction Processing Using a Secure Element

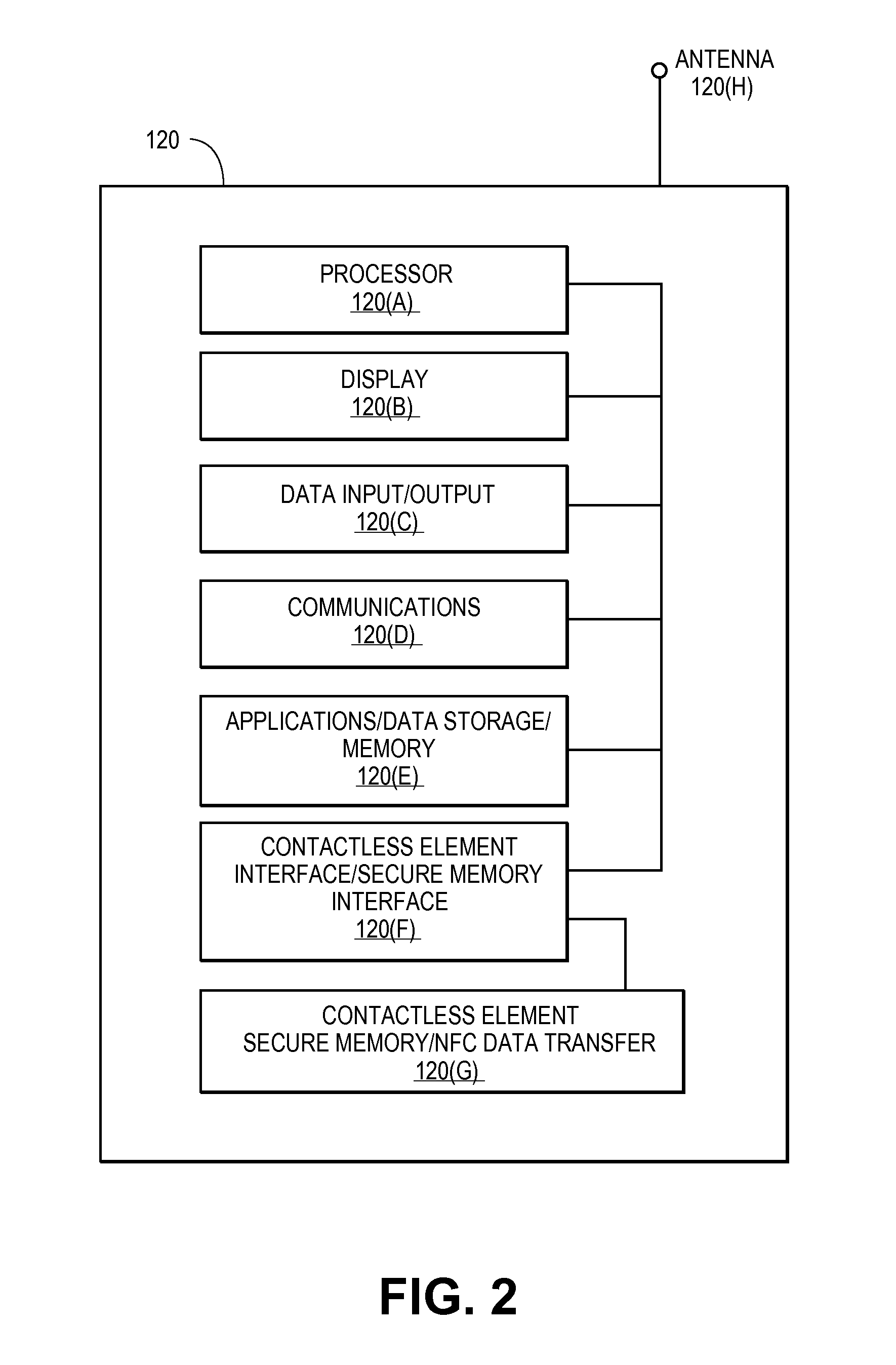

ActiveUS20150052064A1Improve security levelImprove securityPayment protocolsSecuring communicationPayment transactionTransaction data

Embodiments of the present invention are directed to methods, apparatuses, computer readable media and systems for securely processing remote transactions. One embodiment of the invention is directed to a method of processing a remote transaction initiated by a mobile device. The method comprises receiving, by a mobile payment application on a secure memory of the mobile device, transaction data from a transaction processor application on the mobile device. The method further comprises validating that the transaction processor application is authentic and in response to validating the transaction processor application, providing encrypted payment credentials to the transaction processor application. The transaction processor application further initiates a payment transaction with a transaction processor server computer using the encrypted payment credentials.

Owner:VISA INT SERVICE ASSOC

Methods and Systems For Payment Method Selection by a Payee in a Mobile Environment

InactiveUS20080010193A1Unprecedented convenienceUnprecedented flexibilityFinancePayment architectureElectronic communicationMethod selection

Methods and systems for receiving a financial payment facilitated by use of a mobile device such as a mobile telephone (cellphone) or wireless connected personal digital assistant (PDA). A mobile financial transaction system (MFTS) is coupled for wireless communications with a mobile device of a user / payee, and also is coupled for electronic communication with a payment instruction recipient that effects payments by various methods. The system provides information corresponding to a received payment to a user / payee's mobile device. Information is displayed to the user / payee corresponding to a plurality of selectable payment methods available for receiving the payment. The user / payee provides input on his / her mobile device corresponding to selection of a payment method for receiving the payment. The mobile device generates a mobile payment instruction indicating the selected payment method and wirelessly communicates the mobile payment instruction to the MFTS. The MFTS generates and communicates an MFTS payment instruction including an amount, the identified payee, and the selected payment method, to a payment instruction recipient. The payment instruction recipient, in response to receipt of the MFTS payment instruction, effects a payment to the user / payee utilizing the selected payment method.

Owner:QUALCOMM INC

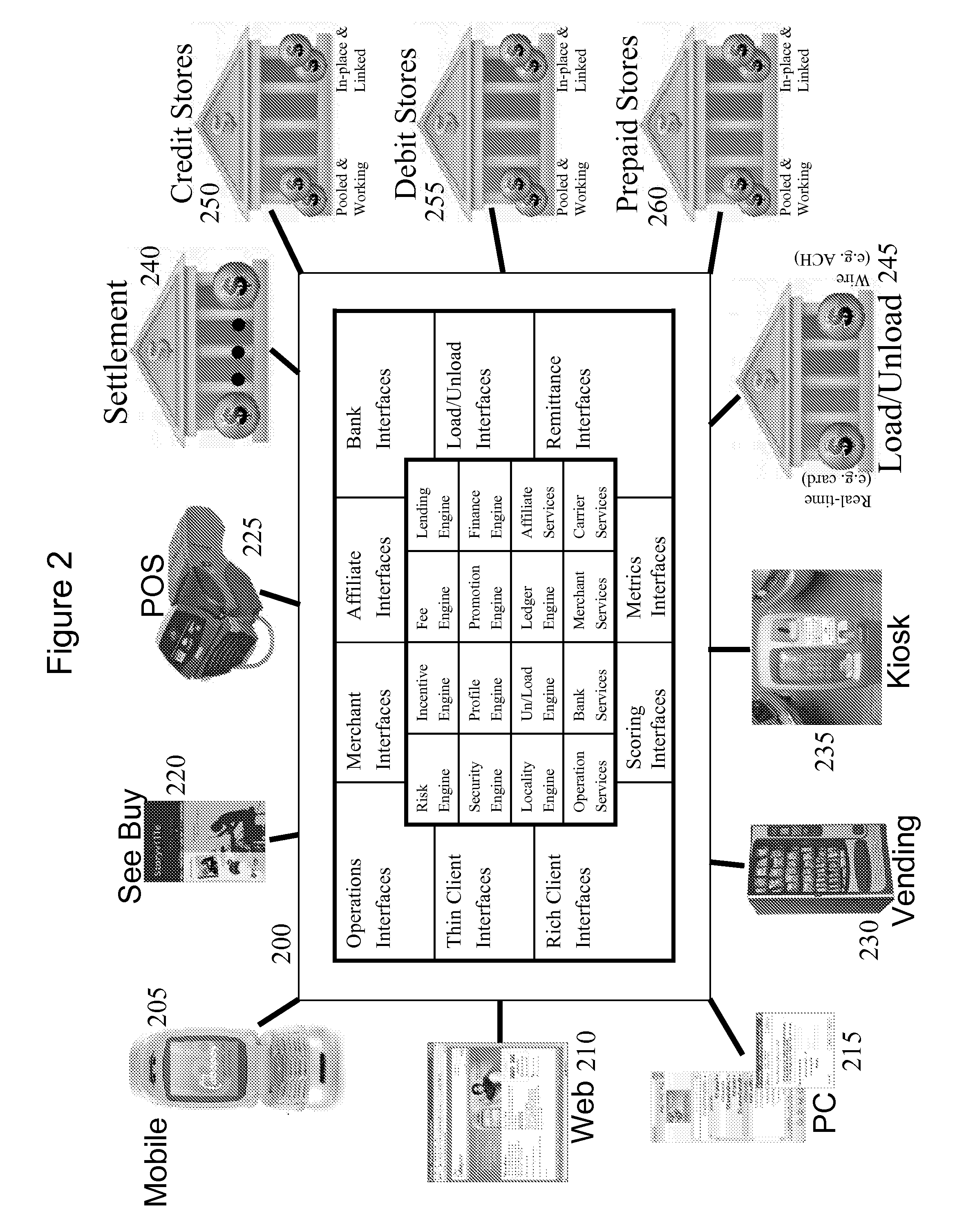

Mobile system and method for payments and non-financial transactions

InactiveUS8635157B2Readily availableLow costFinanceBuying/selling/leasing transactionsVirtual terminalPayment transaction

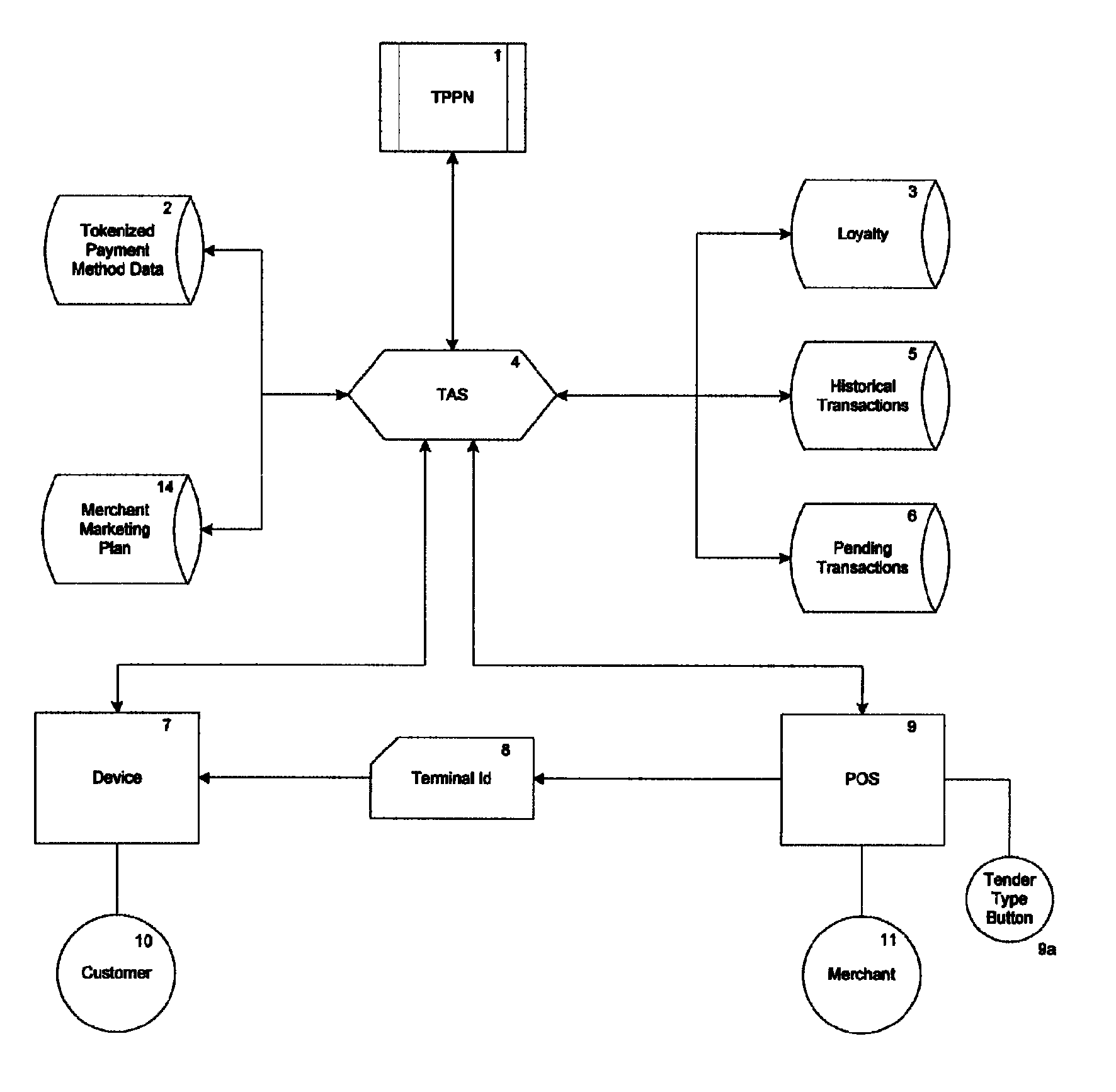

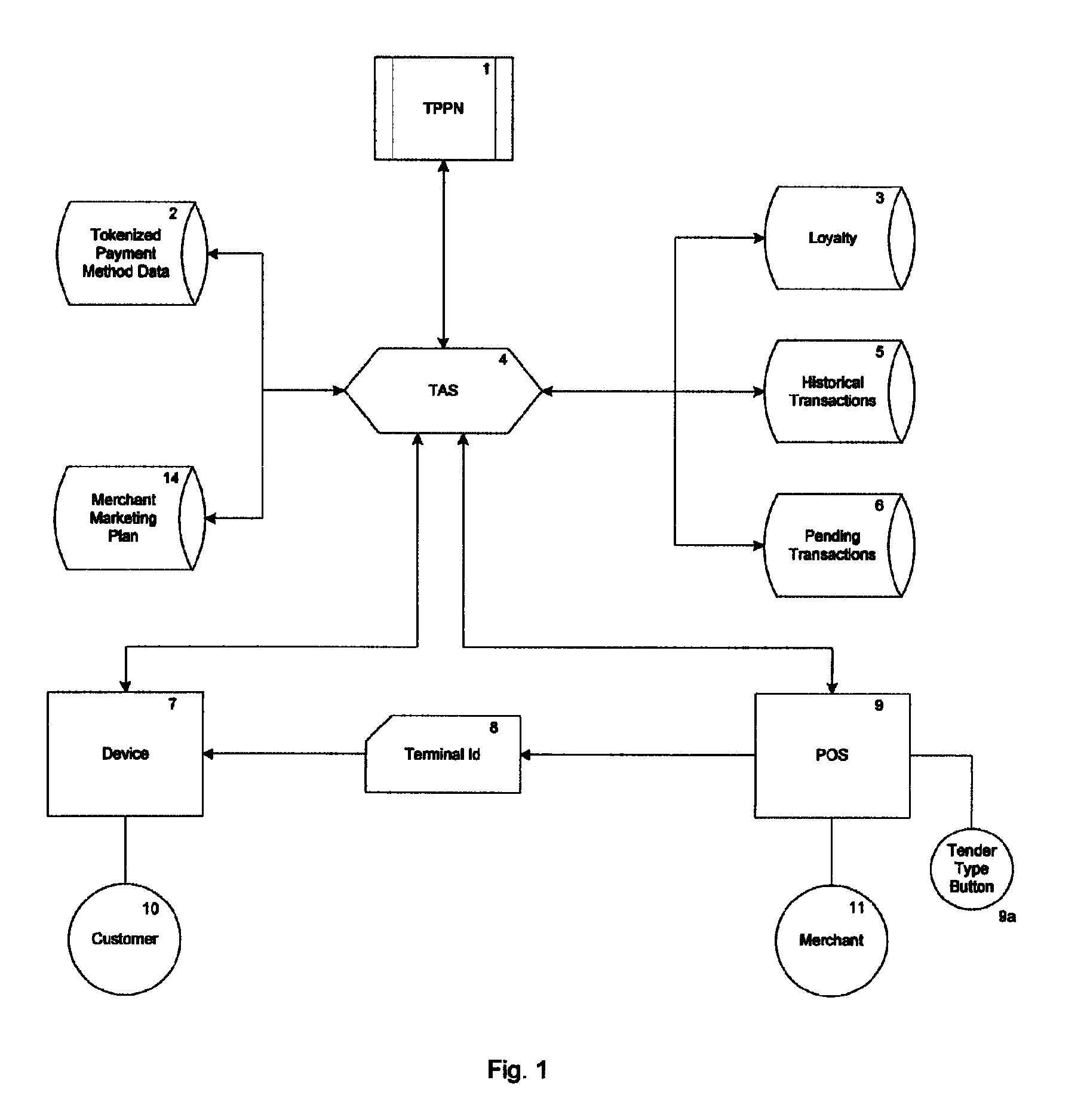

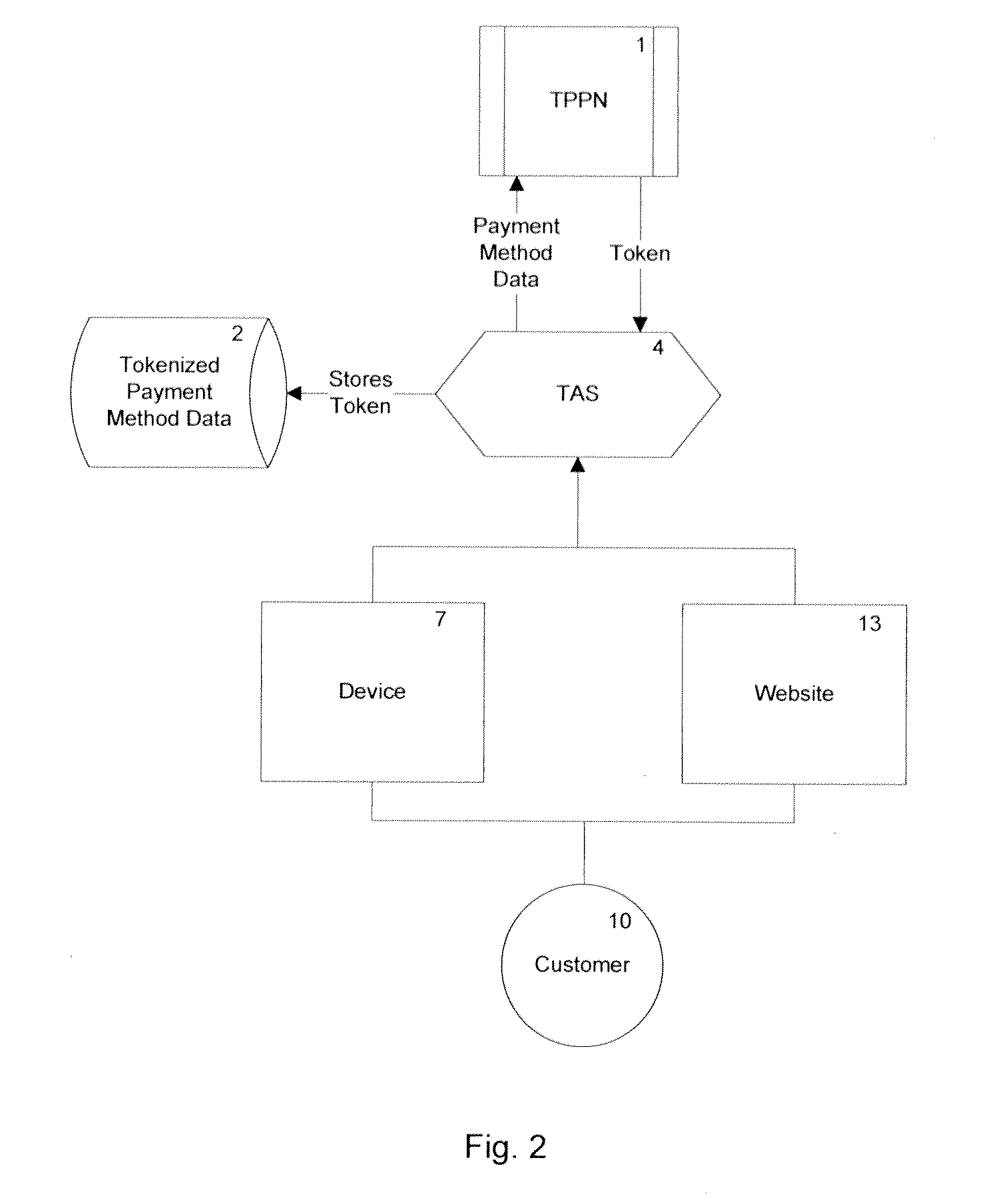

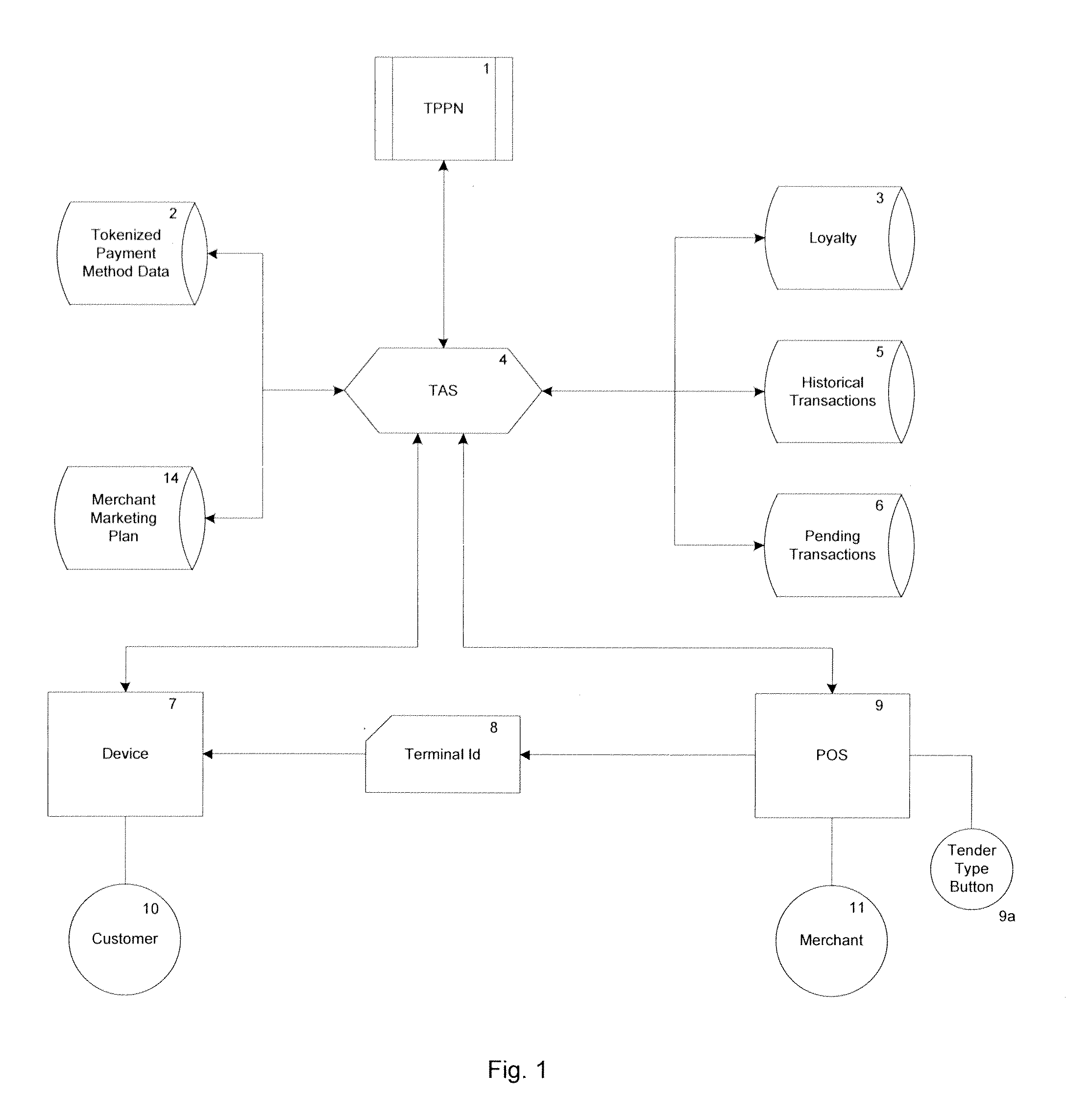

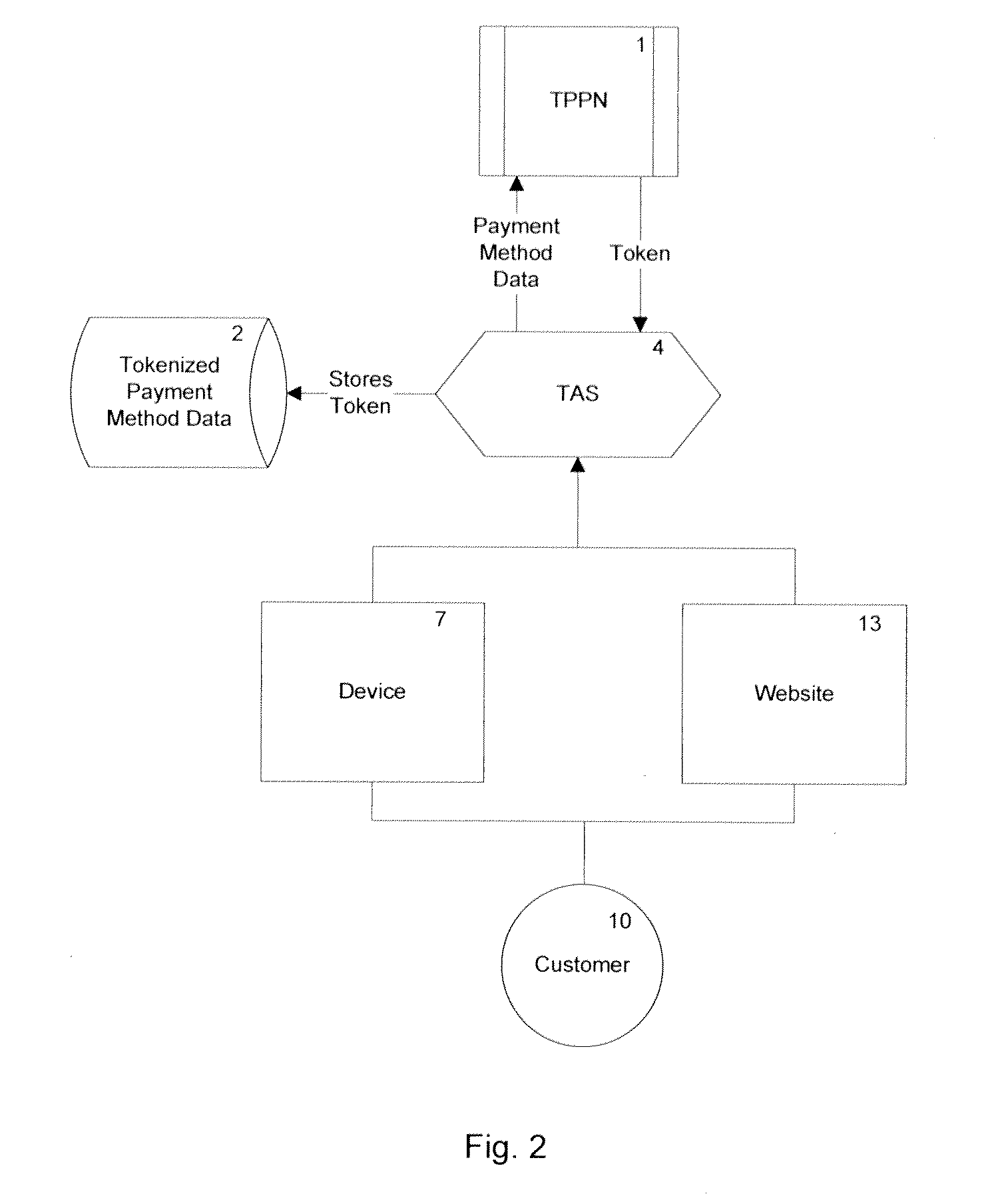

A method and system for mobile commerce, communication, and transaction processing to real-world POS, web, e-commerce, virtual terminal, mobile personal digital assistant, mobile phone, mobile device, or other computer based transactions involving either one or both financial and non-financial such as loyalty based transactions as a mobile payment system is described. One embodiment comprises using a mobile phone via a consumer mobile software application (CMA) in lieu of a consumer card (examples include physical, virtual, or chips) to conduct payment transactions in the Real or Virtual World of commerce. An embodiment is related to making payments to real-world stores via having the CMA on a mobile device on behalf of the consumer present to conduct transactions and no physical card required.

Owner:PAYME

Wireless wallet

Owner:PCMS HOLDINGS INC

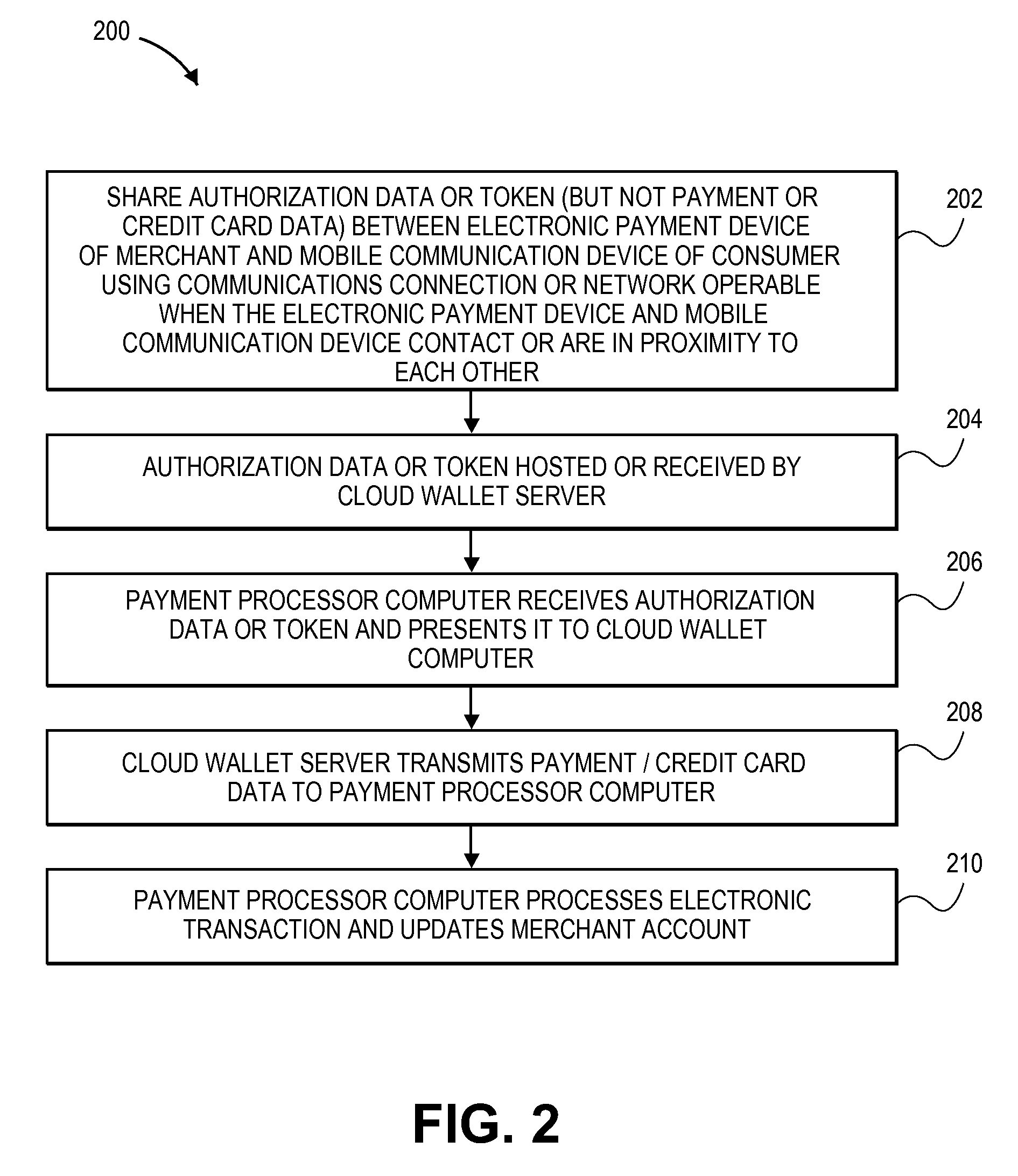

Processing electronic payment involving mobile communication device

ActiveUS20120290376A1The right amountPoint-of-sale network systemsCommerceComputer hardwareCredit card

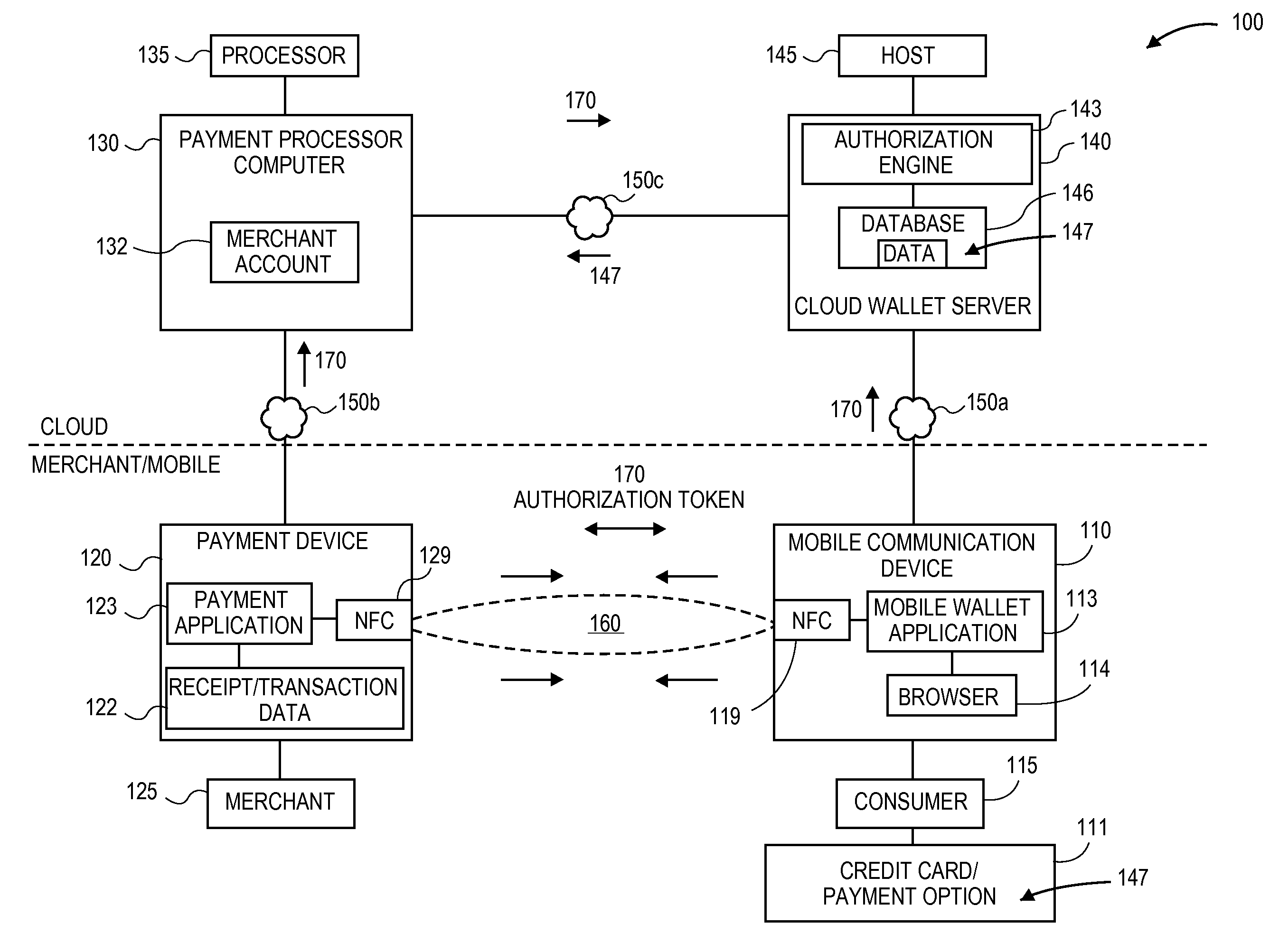

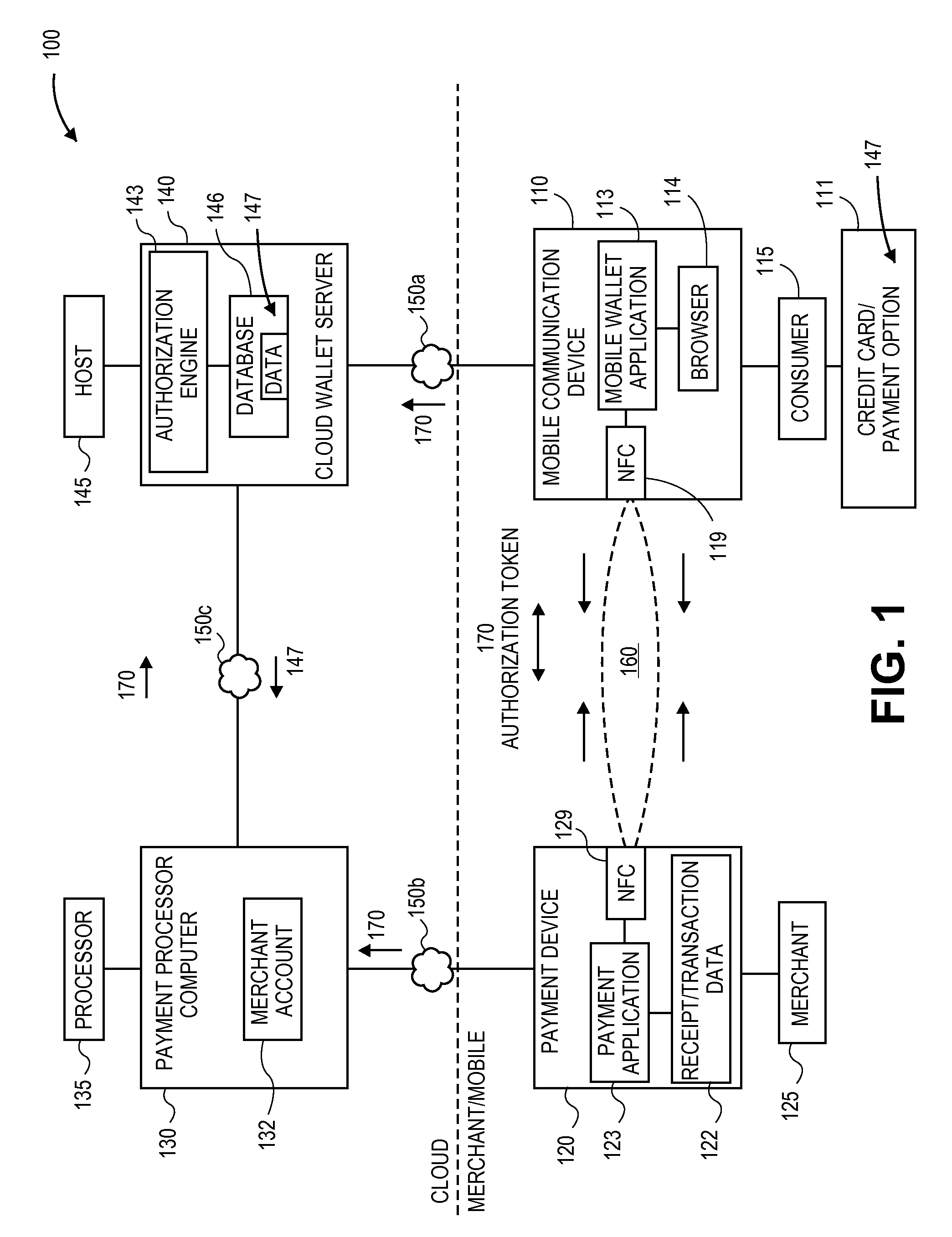

Mobile payments and processing data related to electronic transactions. A near field communication connection is established between a mobile communication device of a consumer that serves as a mobile wallet and an electronic payment device of a merchant. Authorization data is shared between the mobile communication device and the electronic payment device without providing electronic payment instrument (e.g. credit card) data to the merchant. Authorization data is transmitted from the mobile communication device to a cloud computer or resource that serves as a cloud wallet and hosts respective data of respective electronic payment instruments of respective consumers, and from the electronic payment device a payment processor computer. The payment processor computer presents the authorization data to the cloud wallet, and in response, the cloud wallet transmits the credit card data to the payment processor computer, which processes the transaction.

Owner:INTUIT INC

Methods and systems for payment method selection by a payee in a mobile environment

InactiveUS8121945B2Unprecedented convenienceUnprecedented flexibilityFinancePayment architectureElectronic communicationMethod selection

Owner:QUALCOMM INC

Member-supported mobile payment system

InactiveUS8249965B2Low costThe process is simple and fastFinancePayment architectureWireless handheld devicesMobile payment

Owner:OBOPAY MOBILE TECH INDIA PTE LTD

Methods and Systems For Indicating a Payment in a Mobile Environment

InactiveUS20080010192A1Unprecedented convenienceUnprecedented flexibilityFinancePayment architectureElectronic communicationService provision

Methods and systems for indicating a mobile financial payment utilizing a mobile device such as a mobile telephone (cellphone) or wireless connected personal digital assistant (PDA). A mobile financial transaction system (MFTS) is coupled for wireless communications with a mobile device of a user and is also coupled for electronic communications with one or more payment instruction recipients that can make a payment to a payee in behalf of the user. The mobile device allows for selection of a pre-existing payee or entry of payee information. The user provides input at the mobile device selecting a payee for a payment and a payment source for the payment. A mobile payment instruction comprising information corresponding to the payment to make and a payment source for the payment is wirelessly communicated to the MFTS. The MFTS generates and communicates an MFTS payment instruction to a payment instruction recipient which includes information identifying a selected account at a financial service provider, an amount, and information corresponding to the identified payee. The payment instruction recipient then effects the payment to the identified payee.

Owner:QUALCOMM INC

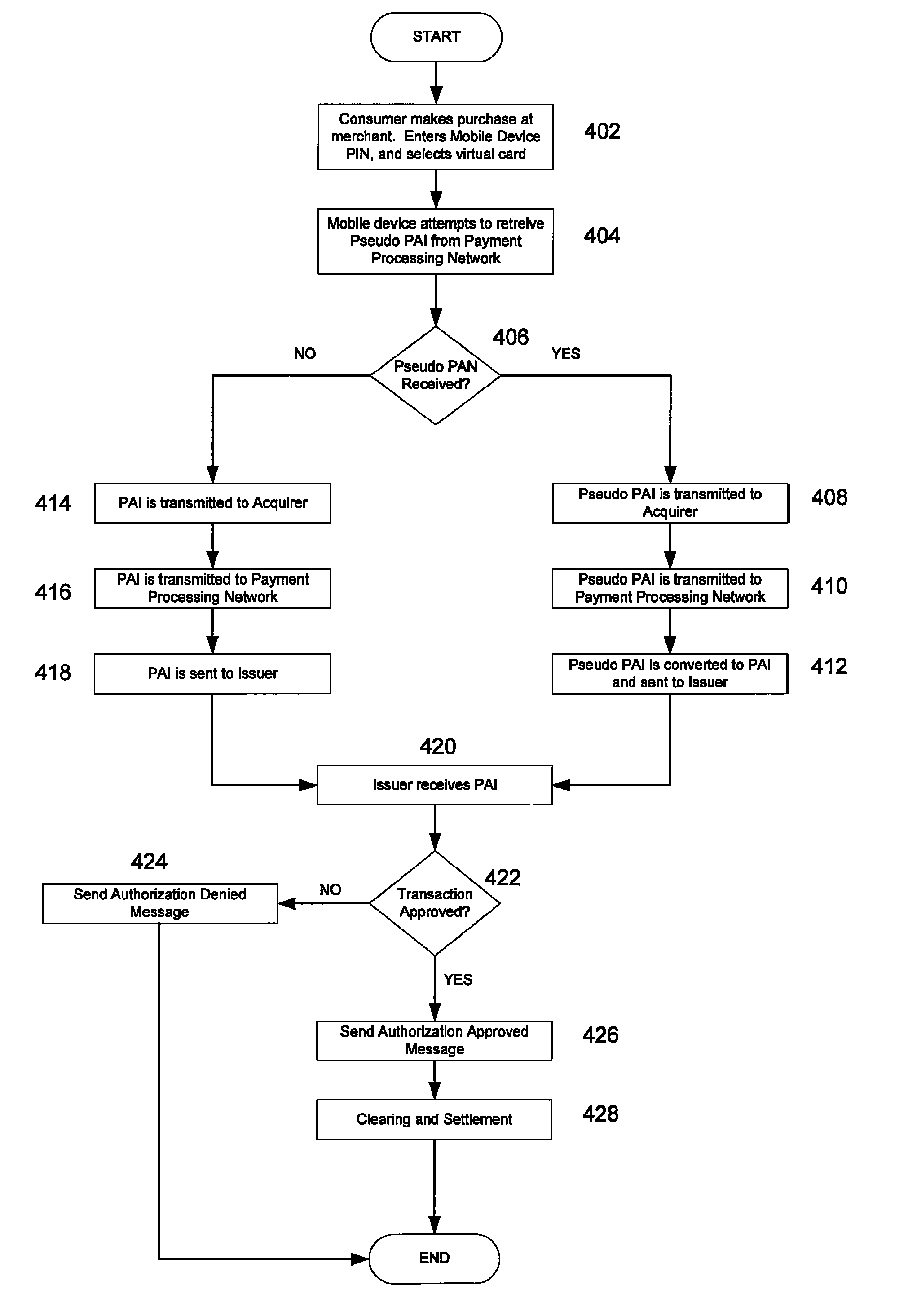

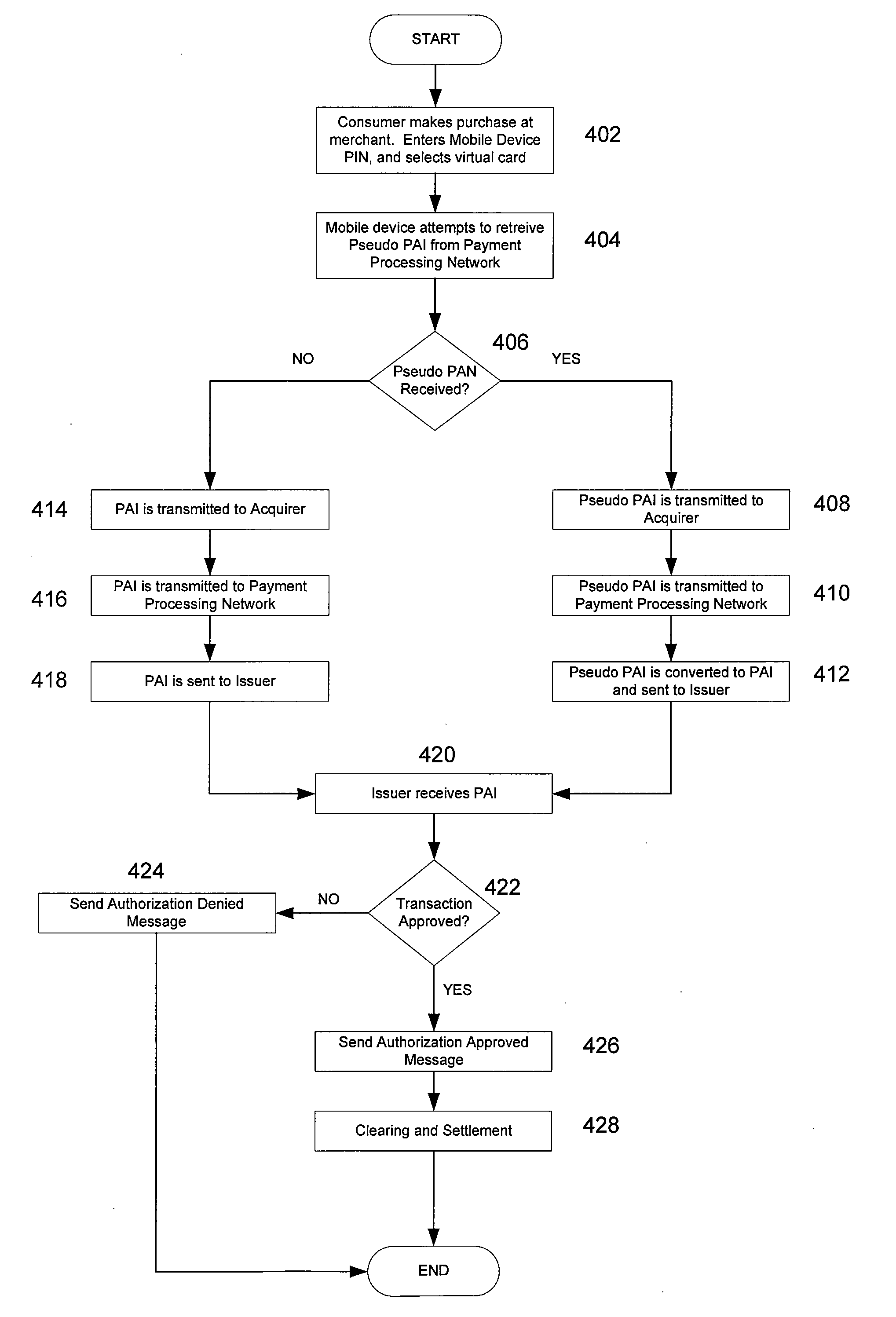

Secure mobile payment system

The present invention provides a method for conducting a transaction that includes receiving a pseudo account identifier that corresponds to a primary account identifier. The pseudo account identifier may be received at a portable wireless device and may be generated by a remote server computer. The portable wireless device can receive the pseudo account identifier over a first network and provide the pseudo account identifier to an access device. The access devices generally comprises a reader that can receive the pseudo account identifier, and thereafter send a message to request authorization of a transaction. The authorization request message may include the pseudo account identifier and is sent to a payment processing network. The authorization request message is sent to the payment processing network over a second network. The payment processing network may then process the authorization message and return a response that indicates if the transaction is authorized or not.

Owner:VISA INT SERVICE ASSOC

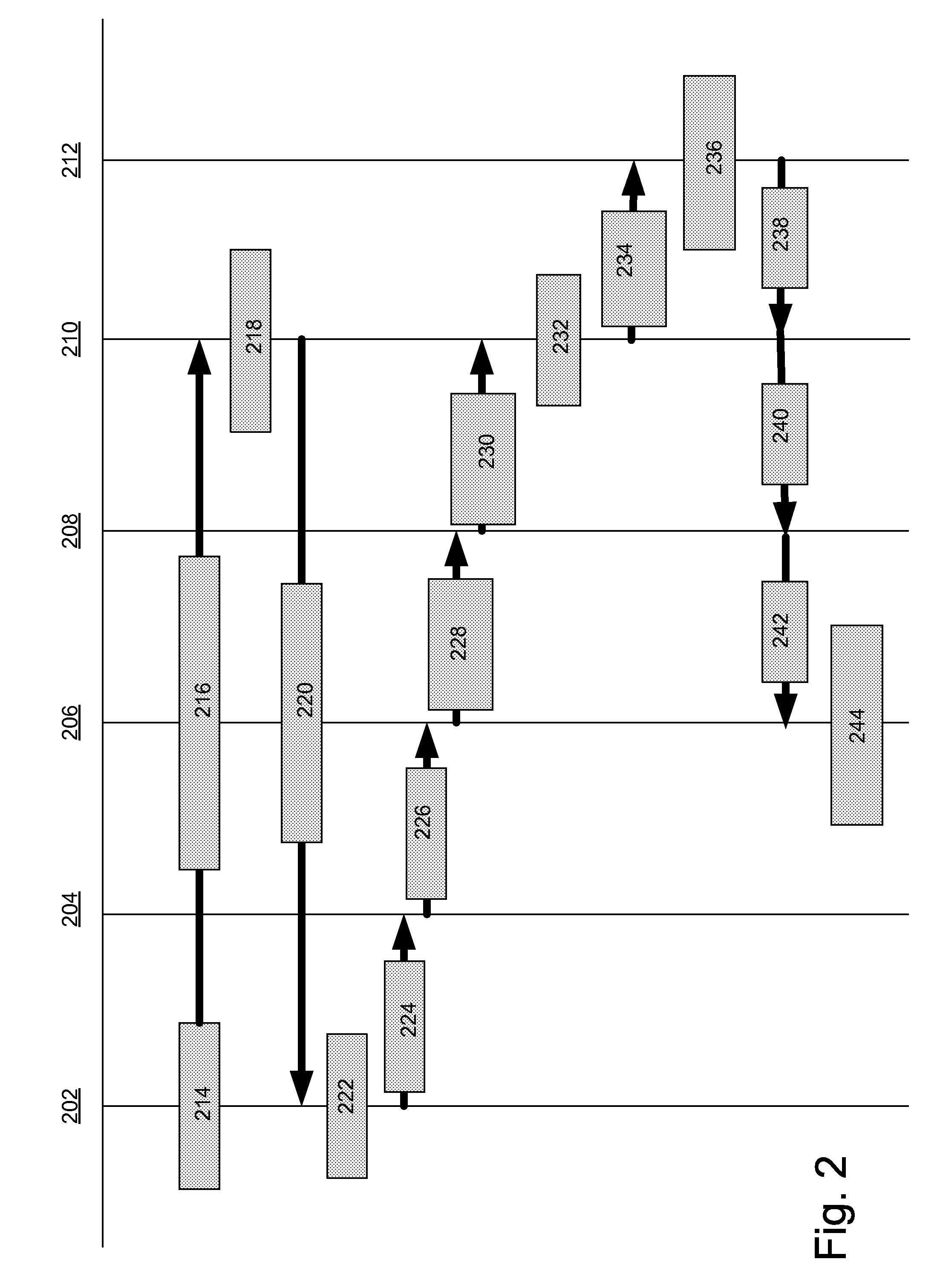

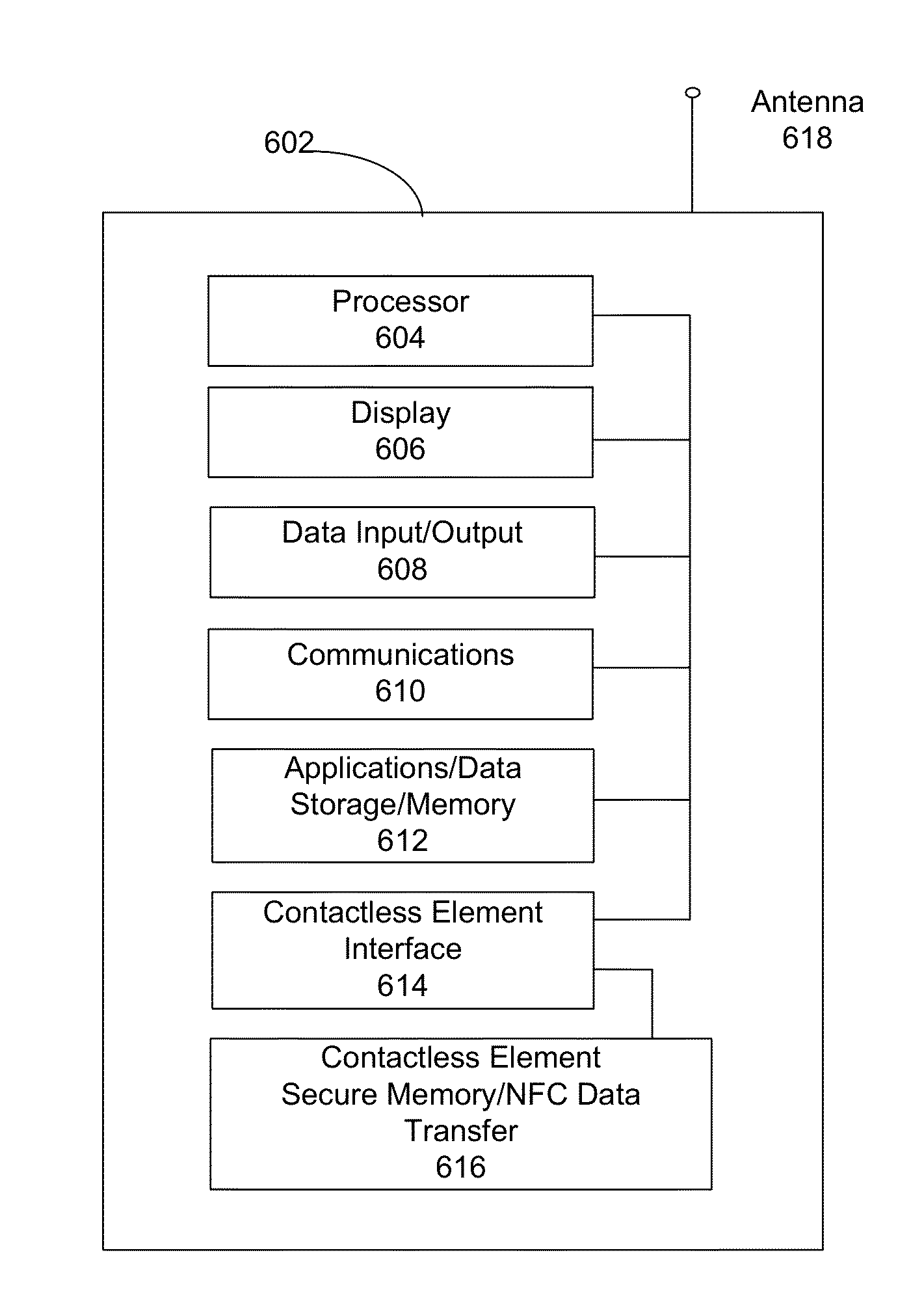

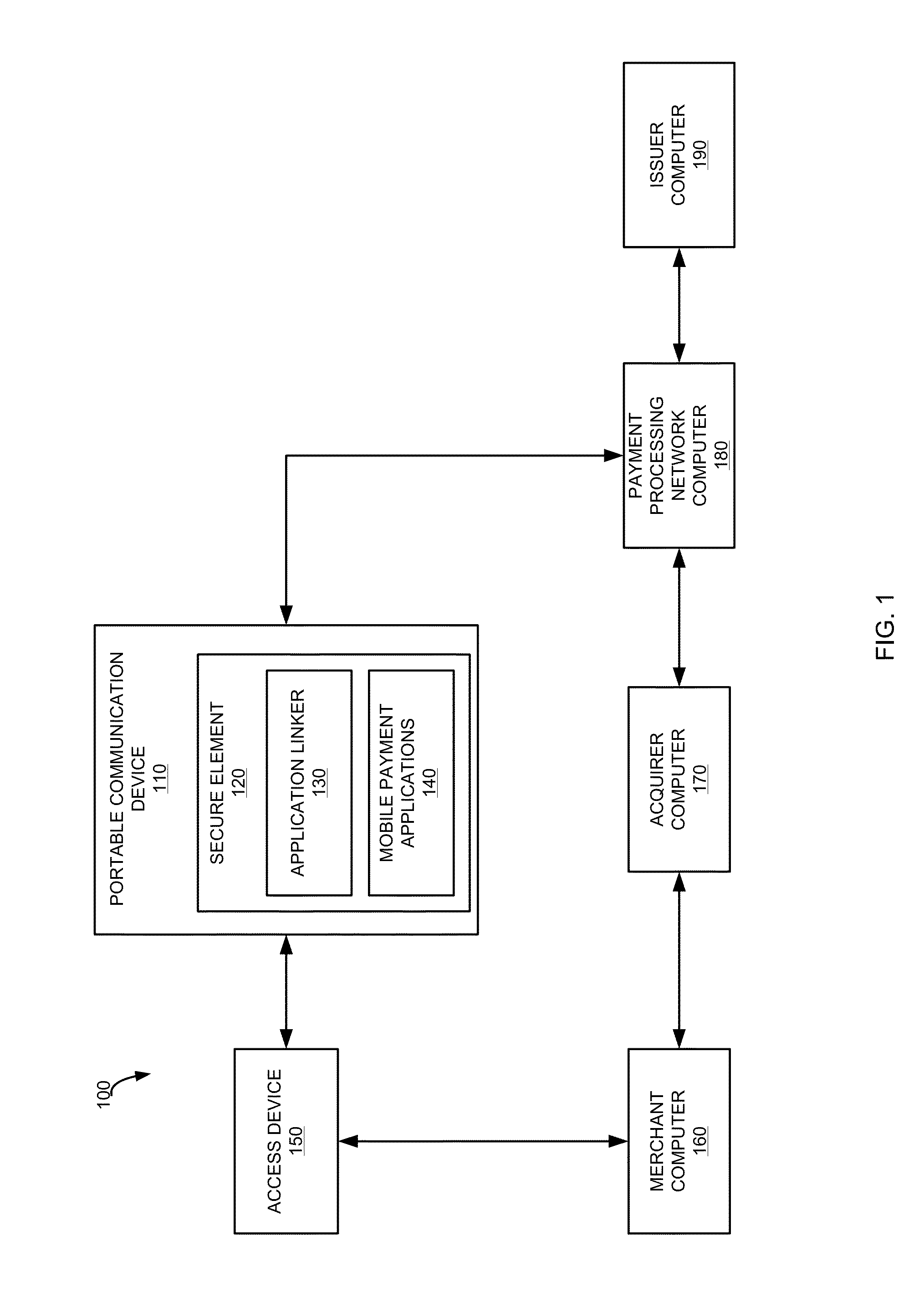

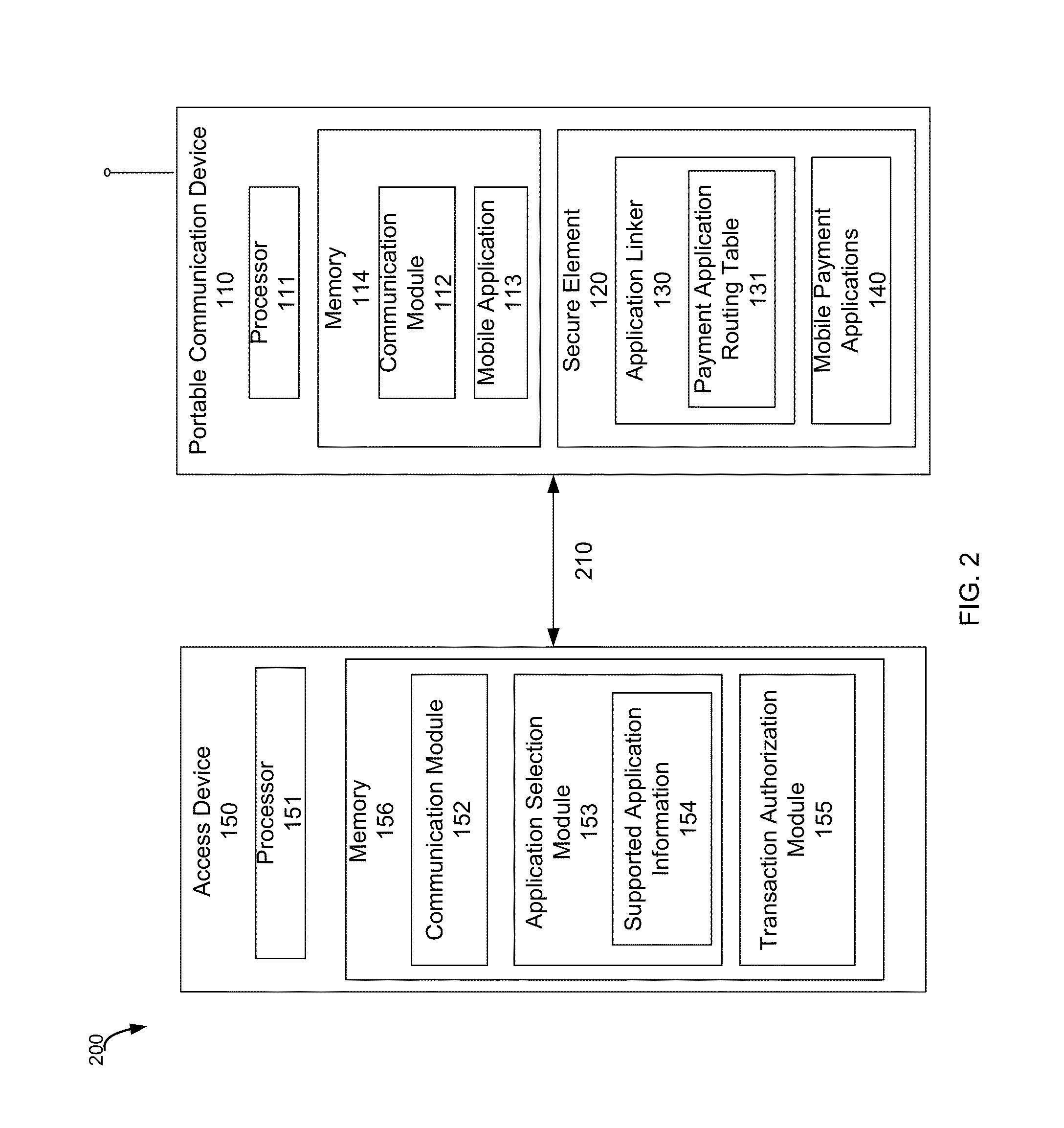

Methods and systems for mobile payment application selection and management using an application linker

An application linker system that manages a plurality of application identifiers associated with a plurality of payment applications present on a device is disclosed. The application linker may manage relationships between application identifiers and payment applications that are provisioned for secure storage on a device. For example, a transaction can be conducted between a portable communication device and an access device. The method includes receiving a request for available payment applications located on the portable communication device from the access device, determining application identifiers associated with payment applications on the device, and sending a list of available payment applications including the application identifiers to the access device. The payment applications store payment information associated with one or more consumer accounts. One of the application identifiers is associated with two or more payment applications.

Owner:VISA INT SERVICE ASSOC

Mobile system and method for payments and non-financial transactions

InactiveUS20120016731A1Readily availableLow costBuying/selling/leasing transactionsPoint-of-sale network systemsVirtual terminalPayment transaction

A method and system for mobile commerce, communication, and transaction processing to real-world POS. web, e-commerce, virtual terminal, mobile personal digital assistant, mobile phone, mobile device, or other computer based transactions involving either one or both financial and non-financial such as loyalty based transactions as a mobile payment system is described. One embodiment comprises using a mobile phone via a consumer mobile software application (CMA) in lieu of a consumer card (examples include physical, virtual, or chips) to conduct payment transactions in the Real or Virtual World of commerce. An embodiment is related to making payments to real-world stores via having the CMA on a mobile device on behalf of the consumer present to conduct transactions and no physical card required.

Owner:PAYME

Mobile Person-to-Person Payment System

InactiveUS20090319425A1The process is simple and fastEasy and fast accessFinancePayment architectureBarcodeFinancial transaction

A mobile payment platform and service provides a fast, easy way to make payments by users of mobile devices. The platform also interfaces with nonmobile channels and devices such as e-mail, instant messenger, and Web. In an implementation, funds are accessed from an account holder's mobile device such as a mobile phone or a personal digital assistant to make or receive payments. Financial transactions can be conducted on a person-to-person (P2P) or person-to-merchant (P2M) basis where each party is identified by a unique indicator such as a telephone number or bar code. Transactions can be requested through any number of means including SMS messaging, Web, e-mail, instant messenger, a mobile client application, an instant messaging plug-in application or “widget.” The mobile client application, resident on the mobile device, simplifies access and performing financial transactions in a fast, secure manner.

Owner:OBOPAY INC

Methods and systems for managing payment sources in a mobile environment

InactiveUS8467766B2Unprecedented convenienceUnprecedented flexibilityFinanceTelephonic communicationElectronic communicationFinancial transaction

Methods and systems for selecting a payment source for use in making a mobile financial payment utilizing a mobile device such as a mobile telephone (cellphone) or wireless connected personal digital assistant (PDA). A mobile financial transaction system (MFTS) is coupled for electronic communications with one or more financial service providers with which the user maintains one or more accounts, and also for wireless communications with mobile devices. The mobile device displays information corresponding to accounts available to the user as a payment source for use in connection with making a payment using the mobile device. The user selects a payment source for making a payment. The mobile device generates a mobile payment instruction comprising information corresponding to the payment and a selected payment source. The mobile payment instruction is wirelessly communicated to the MFTS. The MFTS generates an MFTS payment instruction that includes an amount, information corresponding to the identified payee, and information indicating the selected payment source. The MFTS payment instruction is communicated to the payment instruction recipient, which effects the payment utilizing the selected payment source.

Owner:QUALCOMM INC

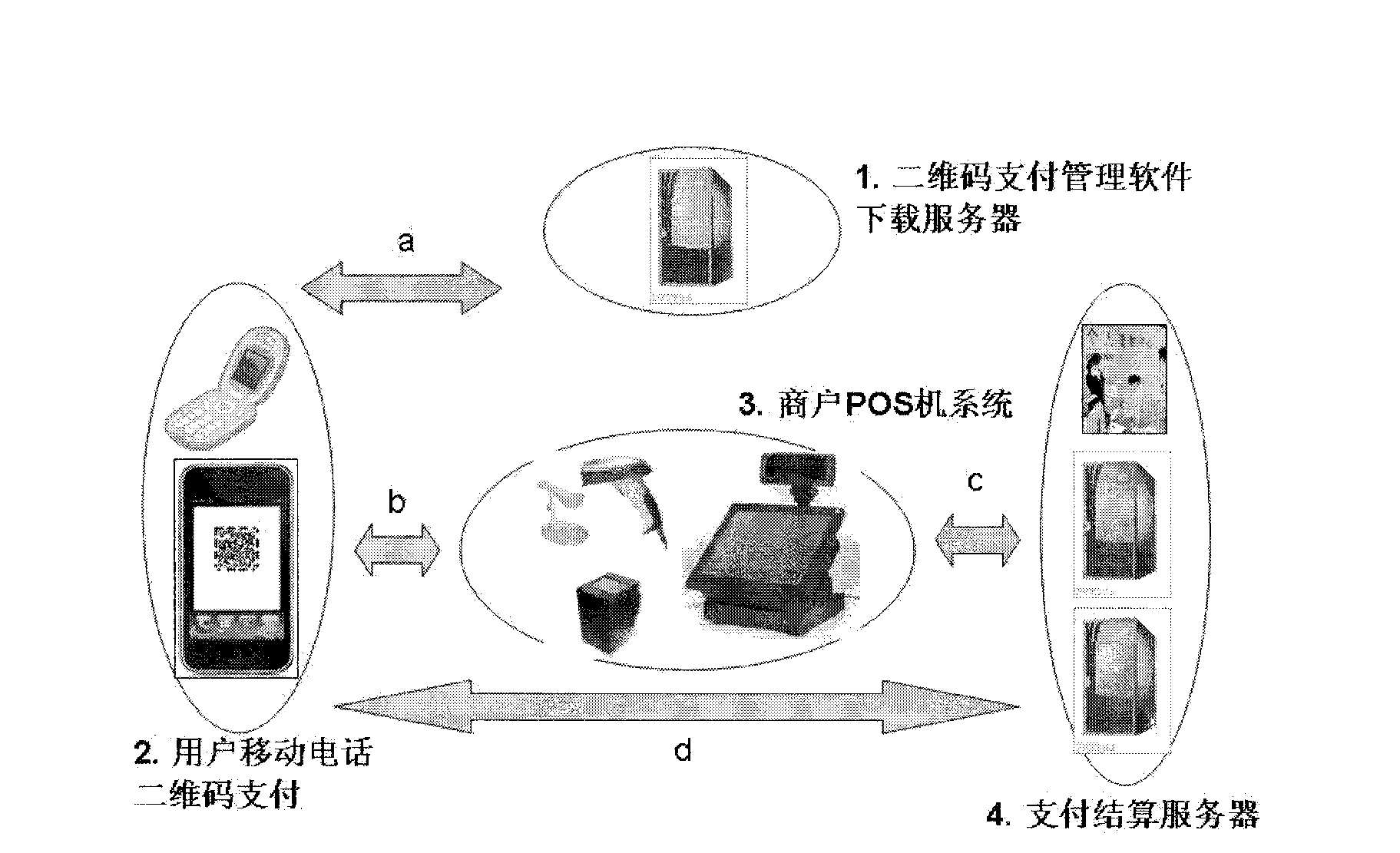

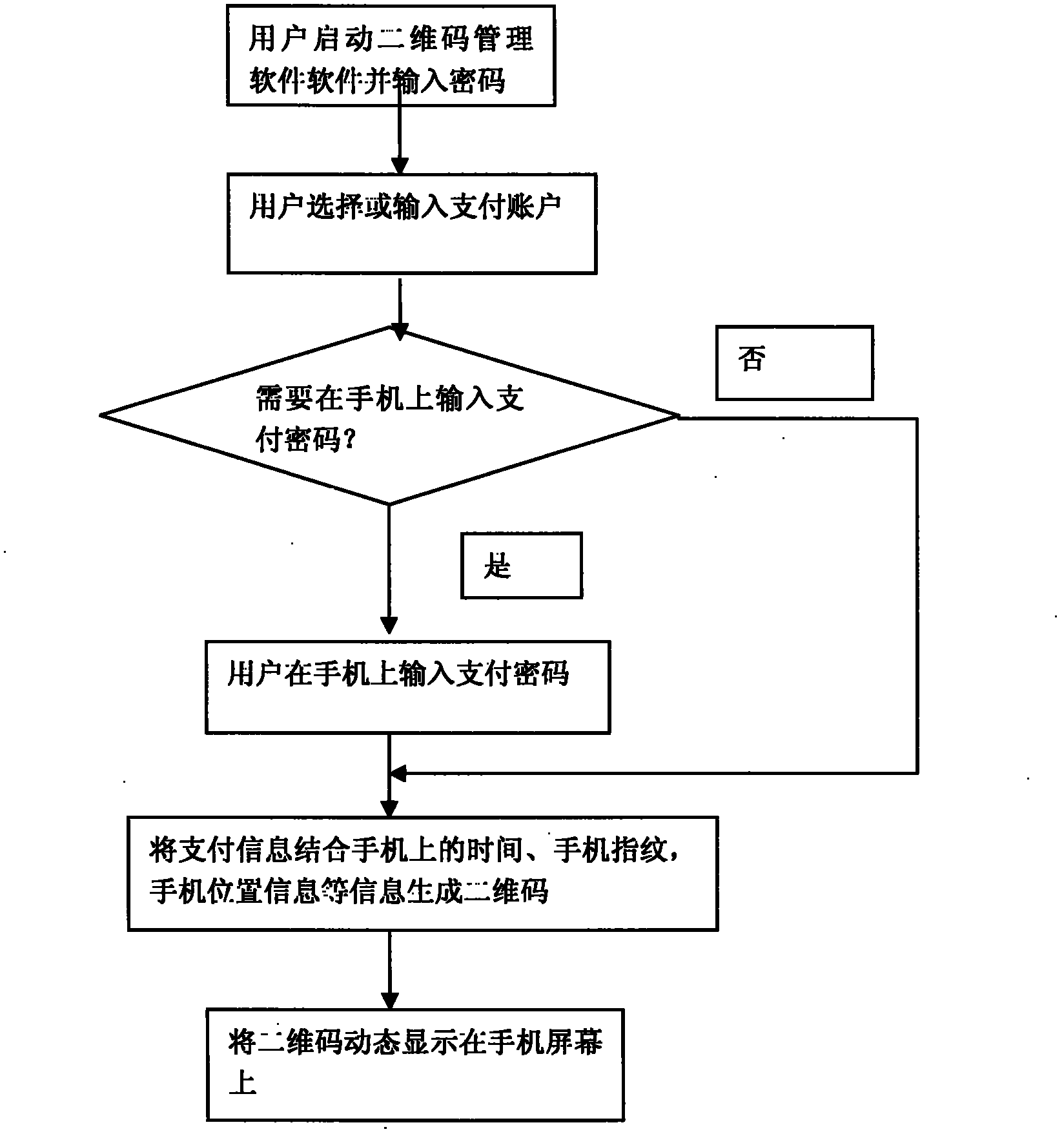

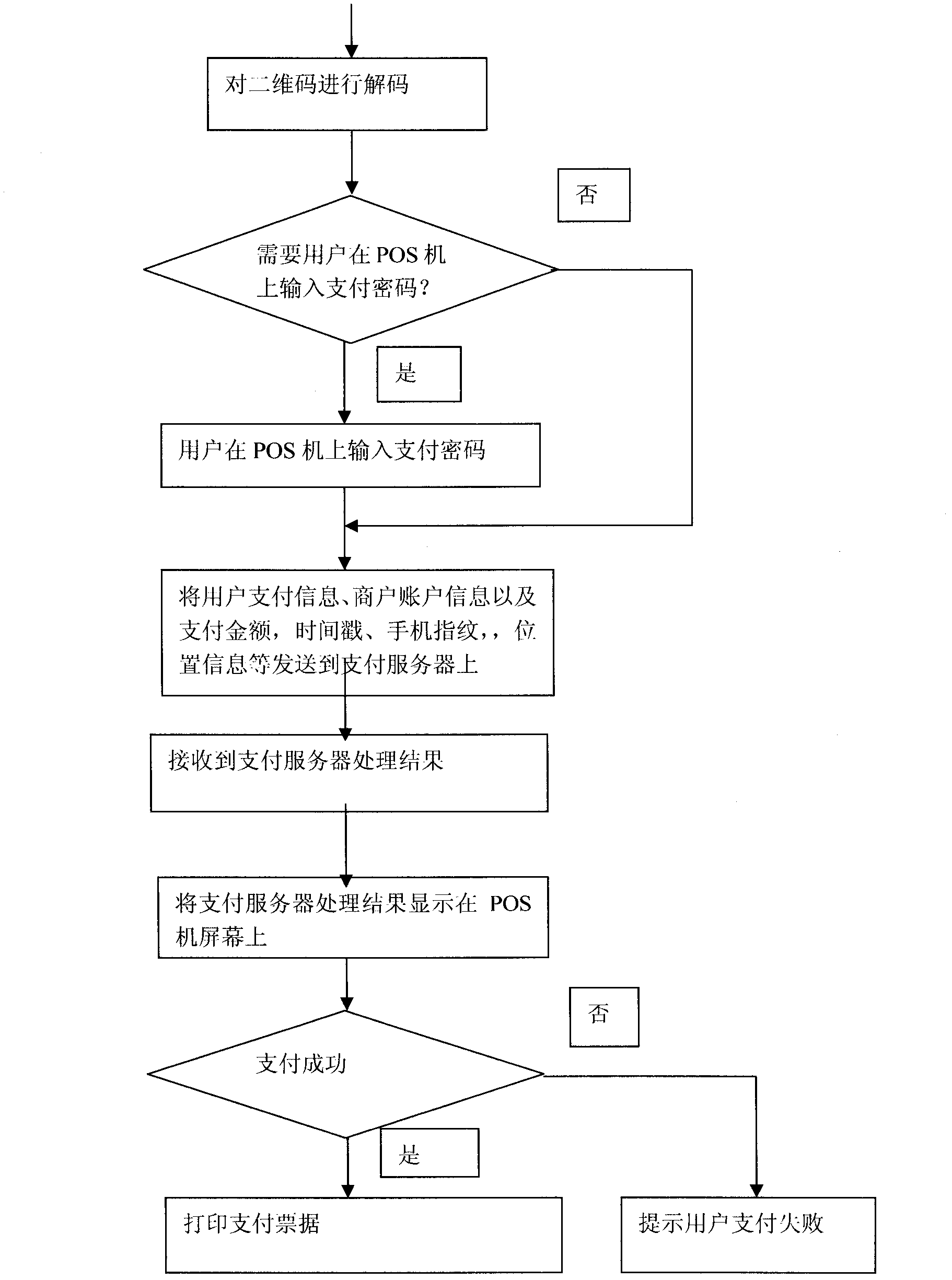

Method for generating two-dimensional code and implementing mobile payment by mobile phone

InactiveCN102842081AEnsure uniquenessEnsure safetyPayment protocolsCoded identity card or credit card actuationComputer hardwareCredit card

The invention relates to a method for generating a two-dimensional code and implementing mobile payment by a mobile phone. A user can input various payment card information (such as bank card account numbers, credit card account numbers, prepaid card account numbers, and third party payment user account numbers) into the mobile phone, the information is enciphered and stored, and then the two-dimensional code is generated and displayed on a screen of the mobile phone. A merchant scans a pattern of the two-dimensional code through a two-dimensional code identifying and reading device, and after user authentication information (such as two-dimensional code generation time, mobile phone fingerprints and mobile phone positions) and the payment card information are decoded, the user authentication information, the payment card information, consumption amount information of the user, merchant account number information and the like are enciphered and sent to a corresponding payment and settlement system. After receiving the information, a payment and settlement server confirms the payment card information to be true or false according to the two-dimensional code authentication information, and carries out payment transaction. The method has the main advantage that the user can save the information of various payment cards, consumption cards and the like in the mobile phone and realize no-card electronic payment transaction instead of the various payment cards.

Owner:上海易悠通信息科技有限公司

Secure mobile payment system

The present invention provides a method for conducting a transaction that includes receiving a pseudo account identifier that corresponds to a primary account identifier. The pseudo account identifier may be received at a portable wireless device and may be generated by a remote server computer. The portable wireless device can receive the pseudo account identifier over a first network and provide the pseudo account identifier to an access device. The access devices generally comprises a reader that can receive the pseudo account identifier, and thereafter send a message to request authorization of a transaction. The authorization request message may include the pseudo account identifier and is sent to a payment processing network. The authorization request message is sent to the payment processing network over a second network. The payment processing network may then process the authorization message and return a response that indicates if the transaction is authorized or not.

Owner:VISA INT SERVICE ASSOC

Audio/acoustically coupled card reader

InactiveUS20100243732A1Firmly connectedOvercome difficultiesSpecial service for subscribersPayment architectureNetwork connectionCard reader

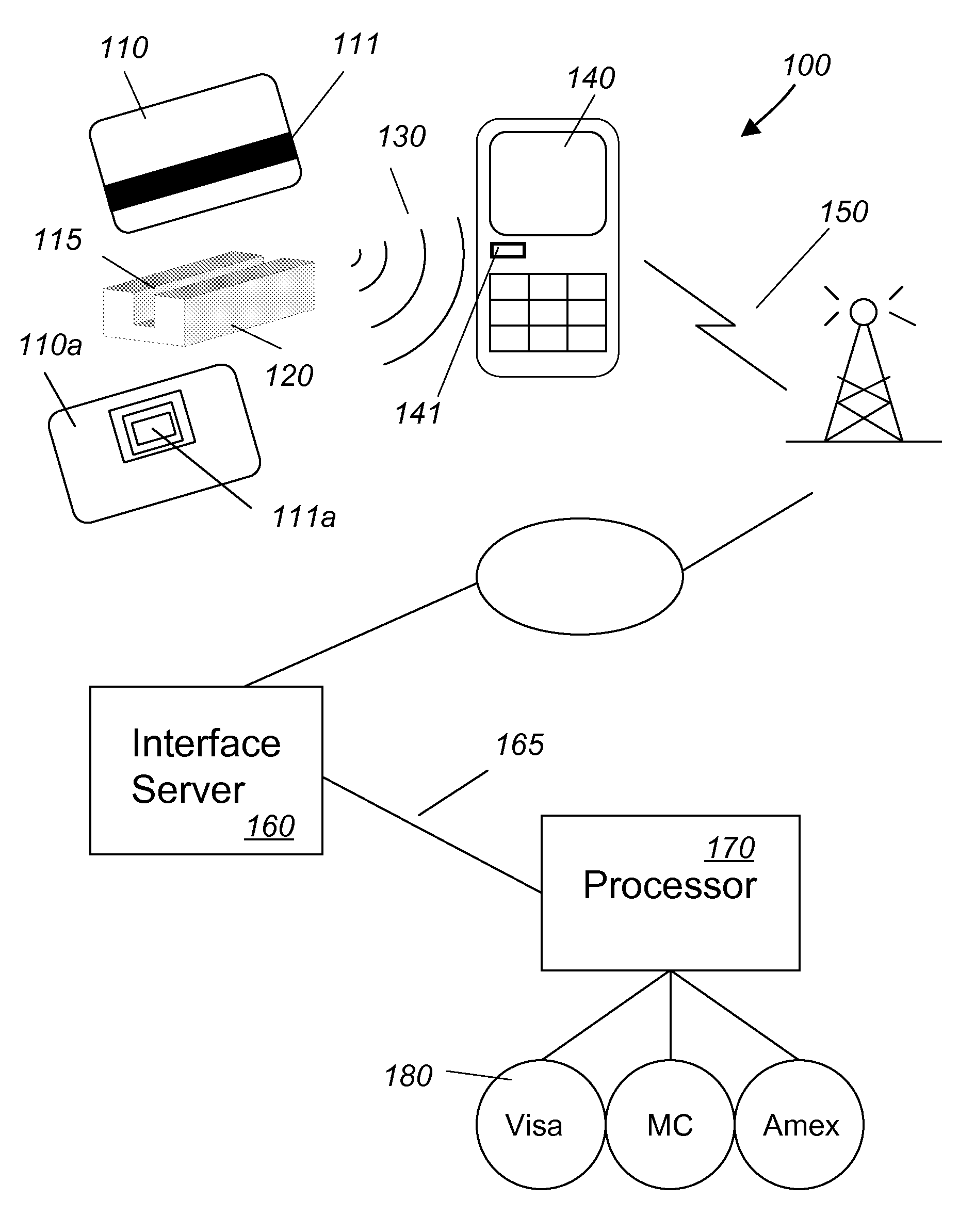

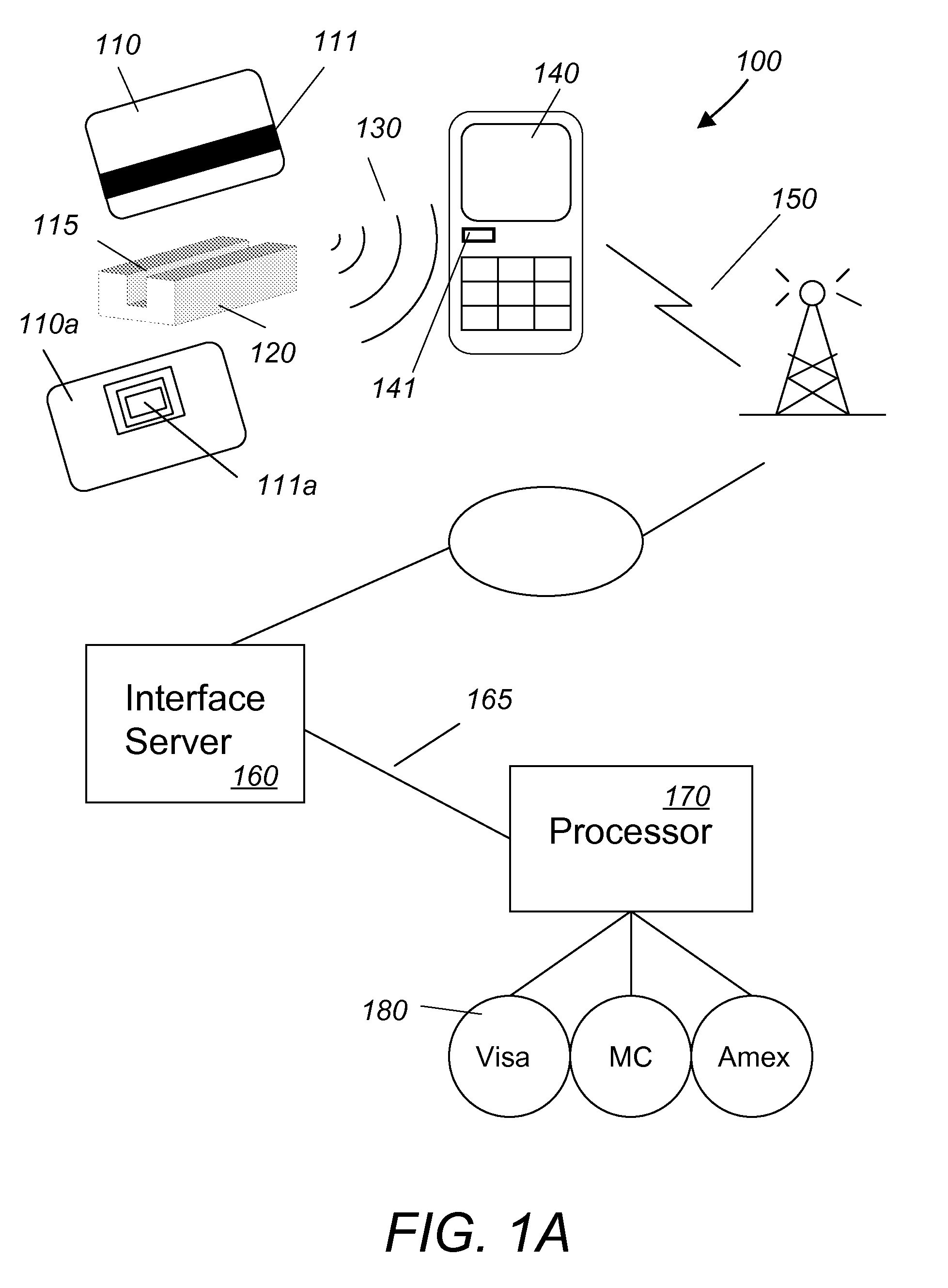

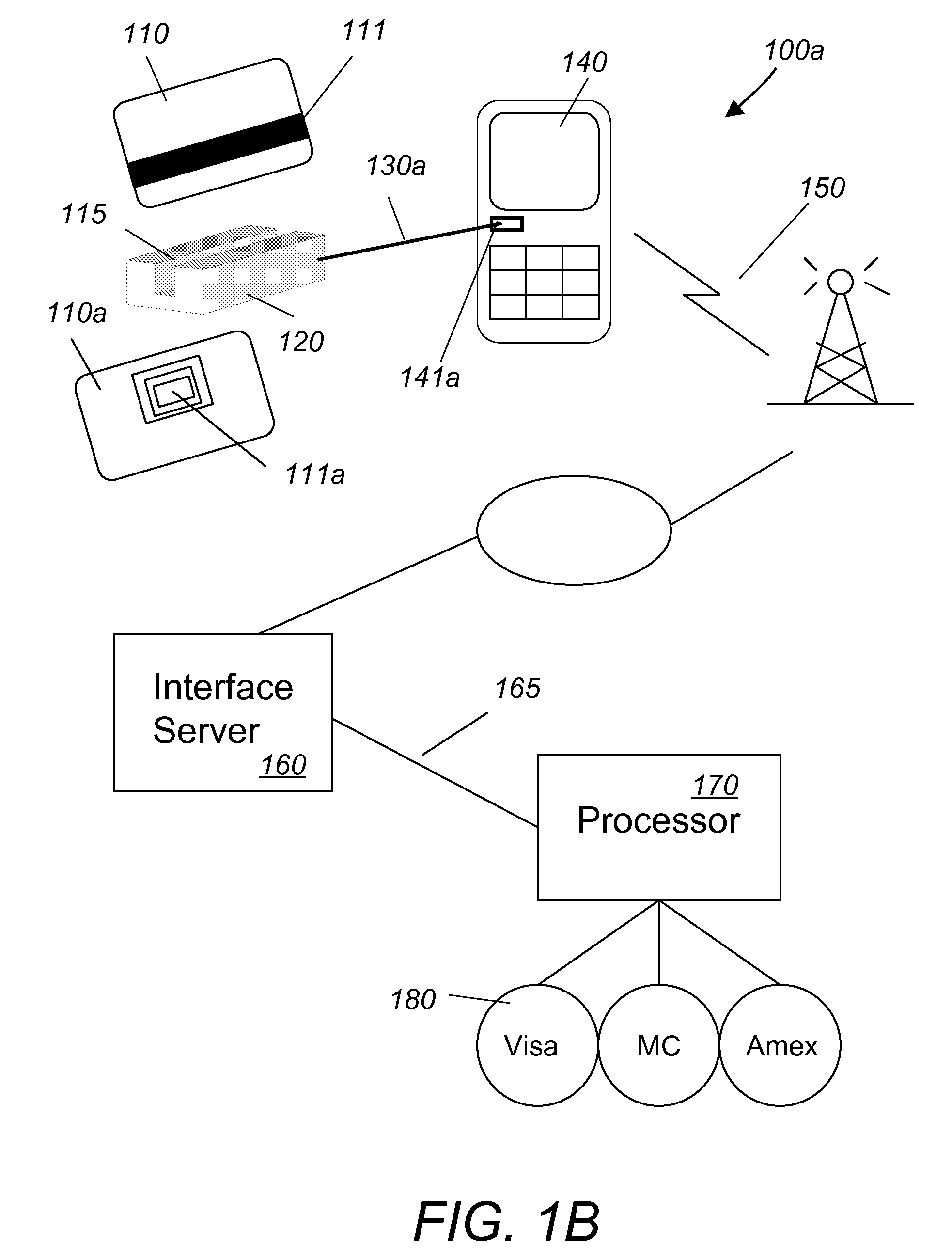

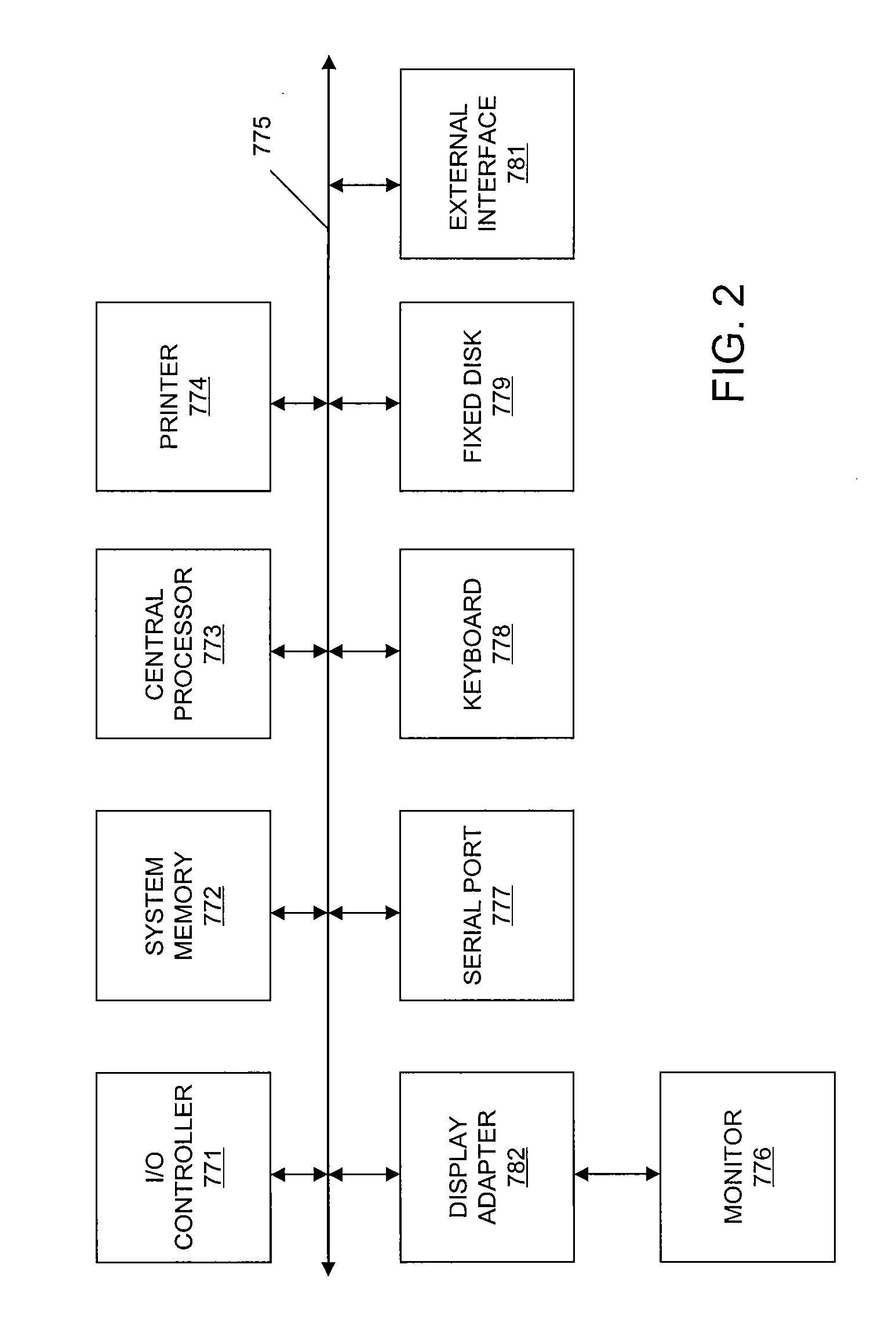

A system for performing mobile payment transactions includes an audio / acoustically coupled card reader, a mobile communication device, an interface server and a payment card processor. The audio / acoustically coupled card reader includes means for reading payment card data from a payment card, means for generating a stream of audio / acoustical signals comprising the payment card data and means for transmitting the stream of audio / acoustical signals. The mobile communication device includes means for receiving the stream of audio / acoustical signals, means for generating an electrical signal comprising data contained in the stream of audio / acoustical signals and means for transmitting the electrical signal. The interface server includes means for extracting the payment card data from the electrical signal and means for transmitting the payment card data. The mobile communication device connects to the interface server device via a first network and transmits the electrical signal to the interface server. The interface server connects to the payment card processor via a second network and transmits the payment card data to the payment card processor for payment processing. The payment card processor processes payments via payment card companies.

Owner:WALLNER GEORGE

Mobile payment system and method using alias

Methods and systems are disclosed for allowing financial transactions to be conducted using mobile phones. A payer initiates a transaction by sending a payment request message from a mobile phone which specifies the payee and amount to be paid. Payees are identified by unique aliases, which are maintained in a database. Methods for assembling the enrollment and alias database are included.

Owner:VISA USA INC (US)

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com