Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

1763 results about "Payment transaction" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Payment transaction definition, payment transaction meaning | English dictionary. payment. n the deposit paid on an item purchased on hire-purchase, mortgage, etc. n usually pl money received by an individual or family from the state or other body, often a pension or unemployment benefit.

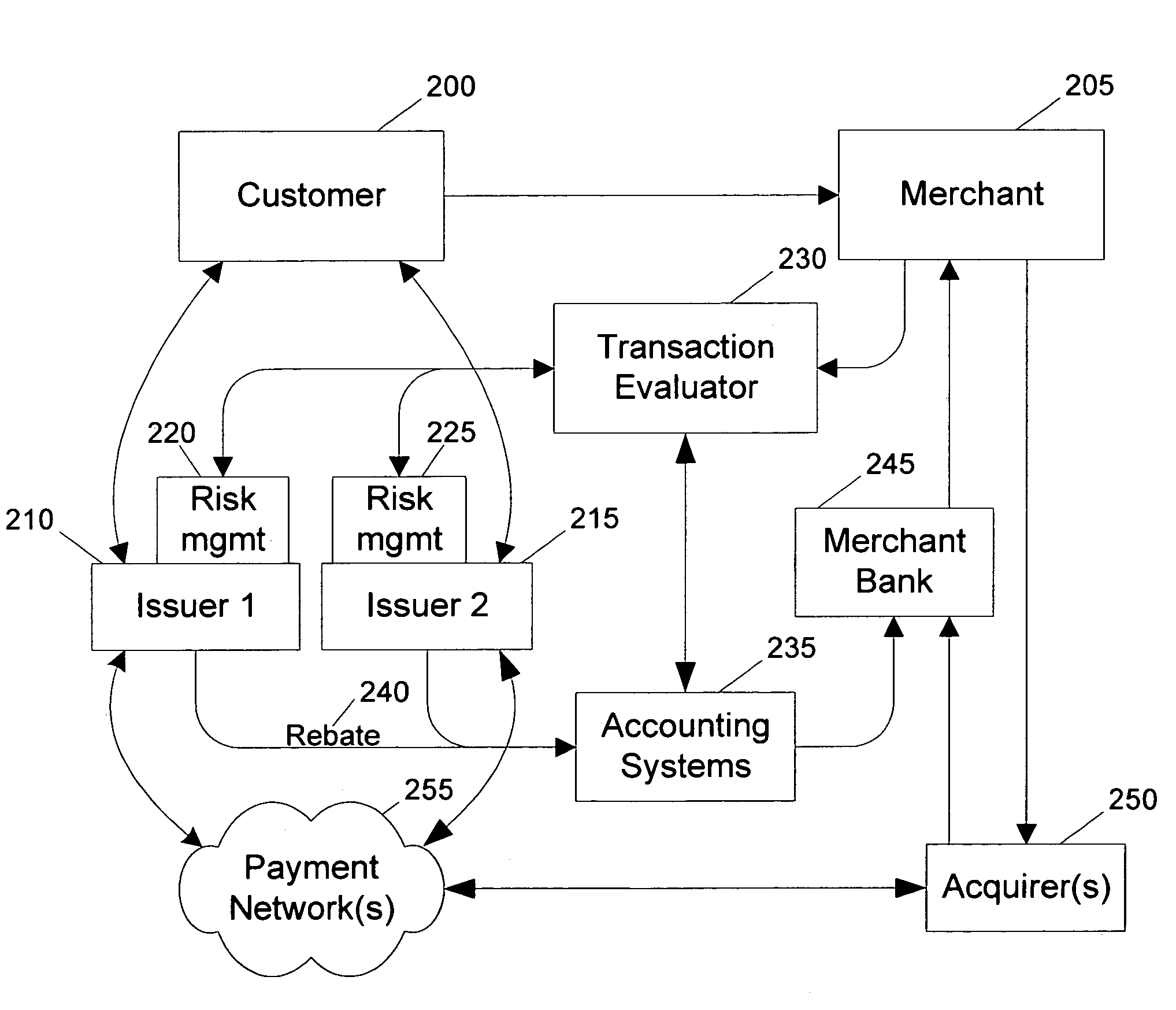

Routing methods and systems for increasing payment transaction volume and profitability

InactiveUS6999943B1More transactionEfficient routingFinancePayment architecturePayment transactionBenefit analysis

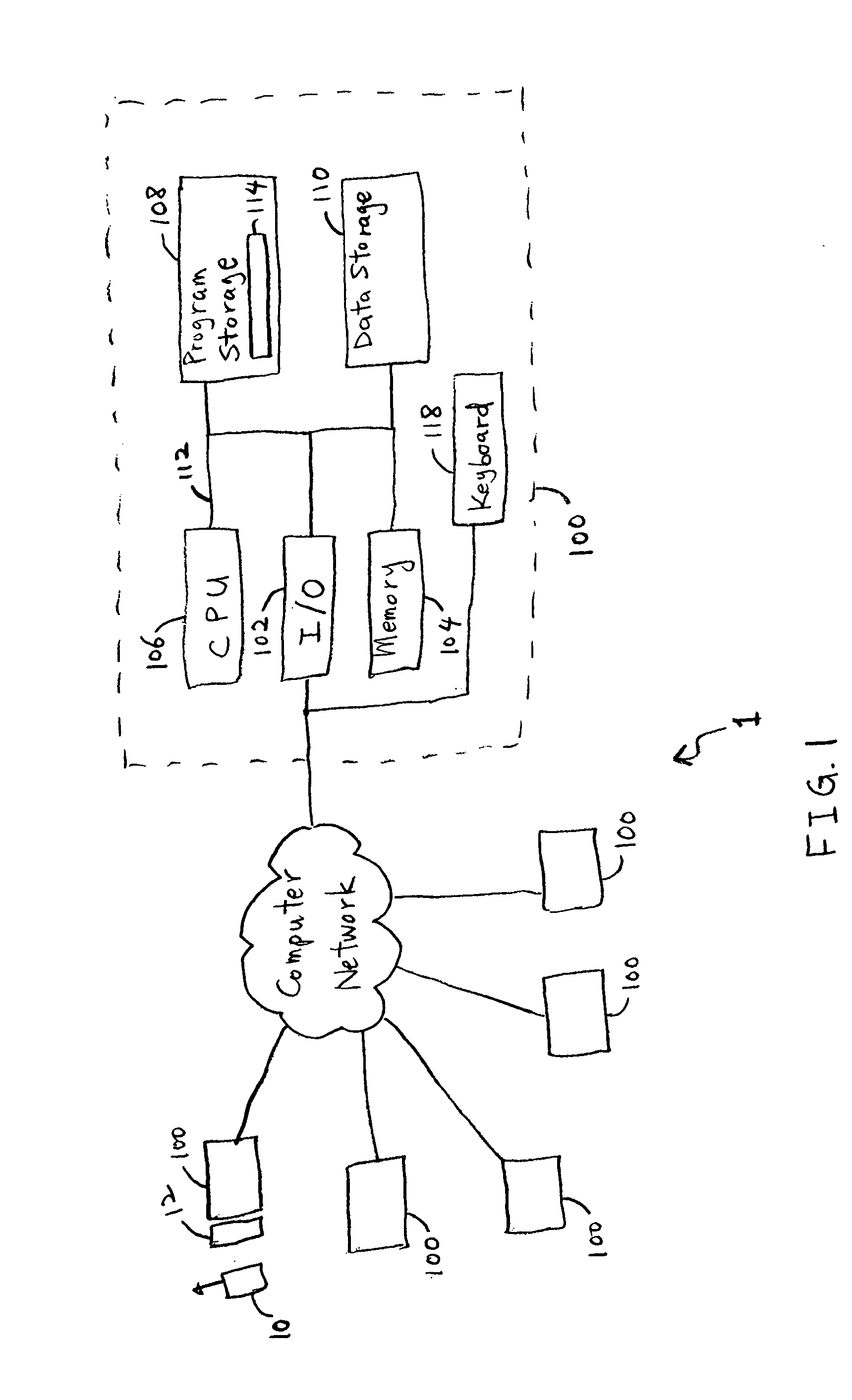

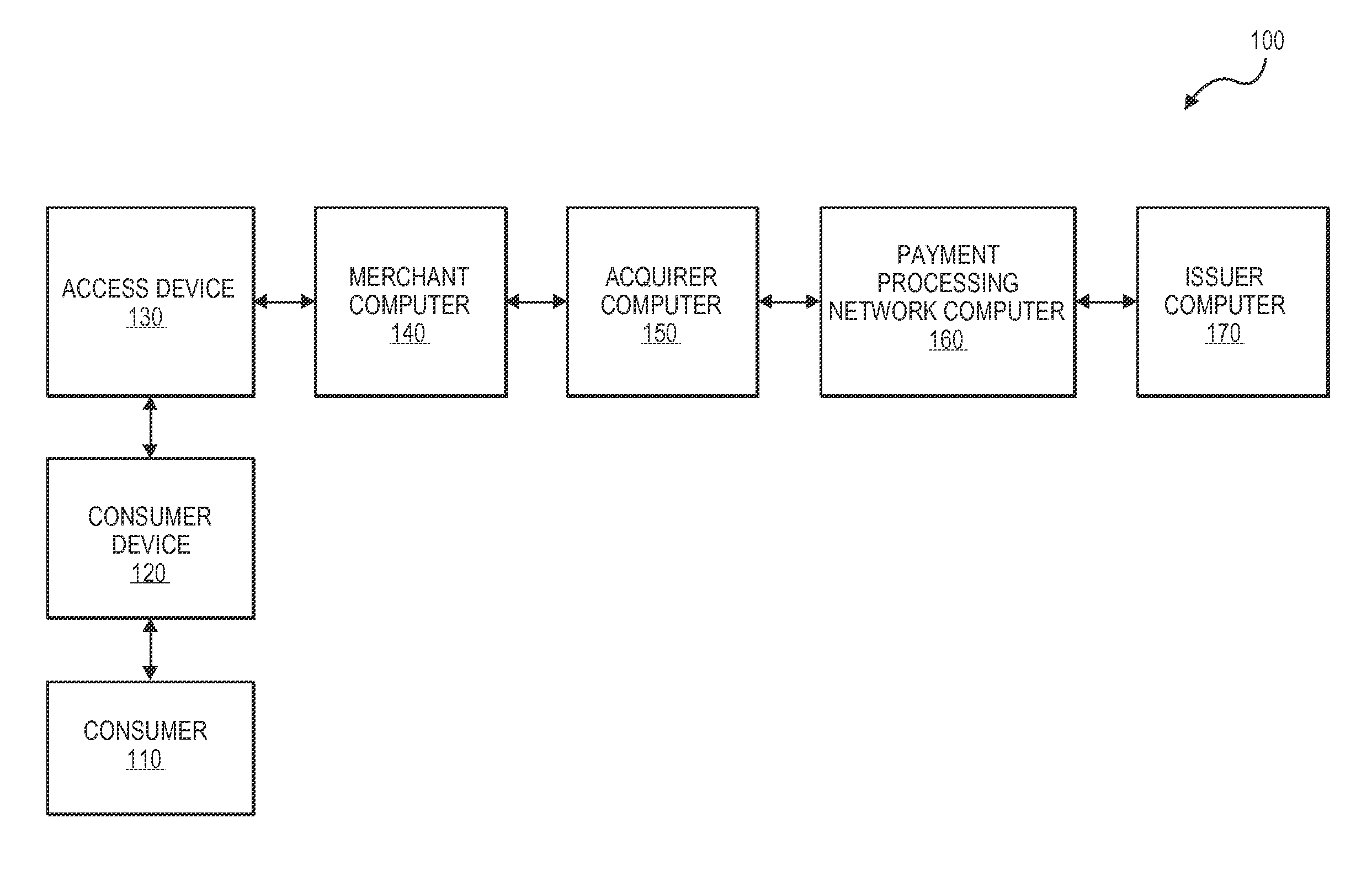

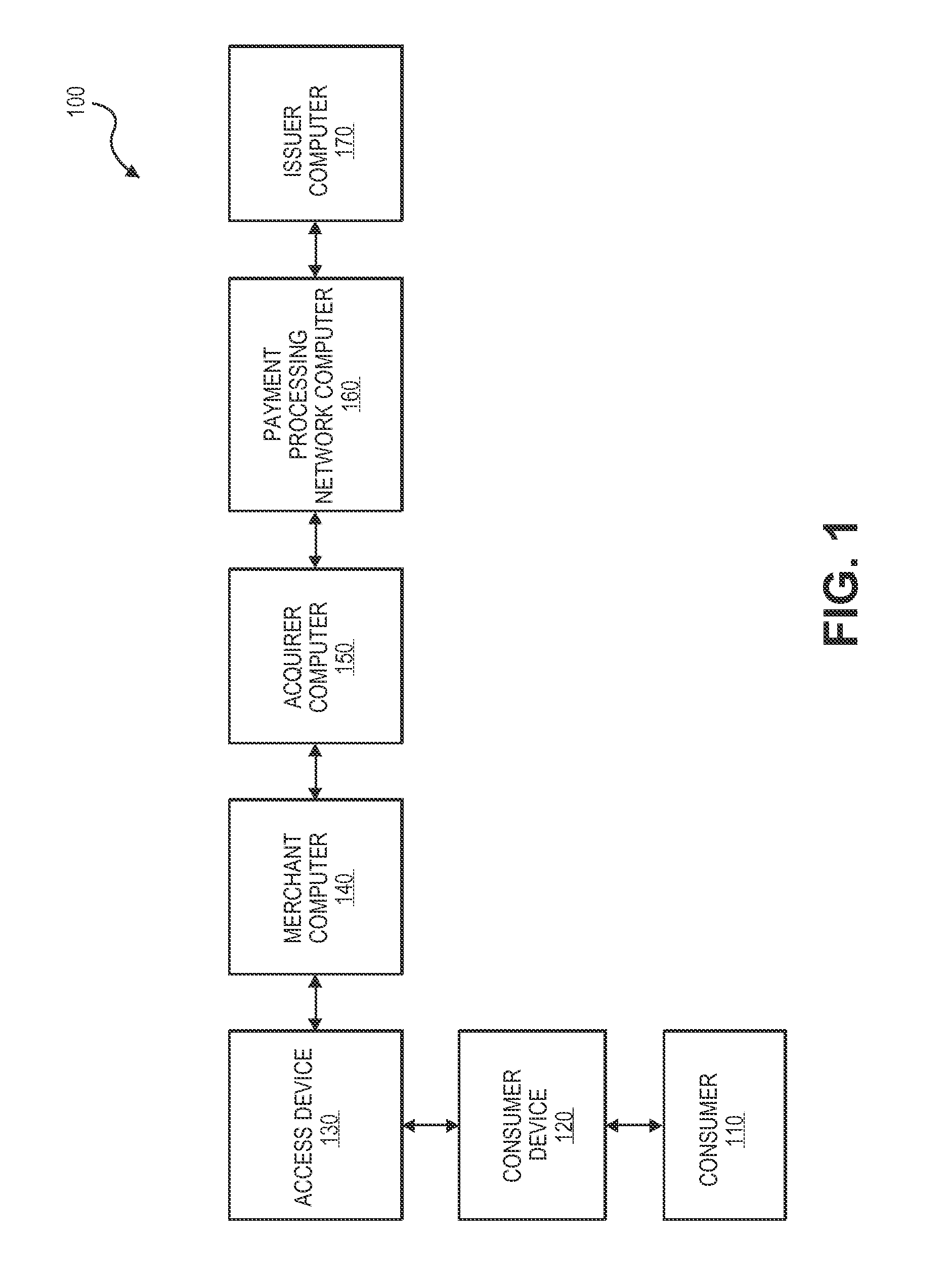

Customers often have access to multiple payment methods for any given transaction. In one embodiment of the invention, a merchant obtains information regarding multiple payment methods from a customer, and sends said information to a transaction evaluator. Via computer networks, the transaction evaluator sends information about the transaction to the issuers of one or more of the payment methods. The issuers perform a cost / benefit analysis of the transactions and respond with a description of the terms under which they are willing to process the transaction. Based on the issuer response, the transaction evaluator selects one of the payment methods. By enabling participating issuers to select favorable transactions and avoid unprofitable ones, the invention can thus improve issuer profitability by directing profitable transactions to participating issuers while directing unprofitable transactions away from participating issuers or to alternate transaction methods that are more profitable or less costly.

Owner:DOUBLECREDIT CORP

Payments using a mobile commerce device

InactiveUS20080208762A1Buying/selling/leasing transactionsPoint-of-sale network systemsPayment transactionAuthorization

Methods, systems, and machine-readable media are disclosed for handling payment transactions in a mobile commerce system. According to one embodiment, a method of processing a payment transaction in a mobile commerce system can comprise receiving at a first acquirer system a communication from a point-of-sale (POS) device. The communication can be related to the payment transaction and can include information identifying a financial account from which a payment is requested. A second acquirer for authorizing the payment can be identified based on the information identifying the financial account. The communication can be sent to the second acquirer system for authorization of the transaction based on the information related to the financial account. An indication of whether the transaction is authorized can be received from the second acquirer system.

Owner:FIRST DATA

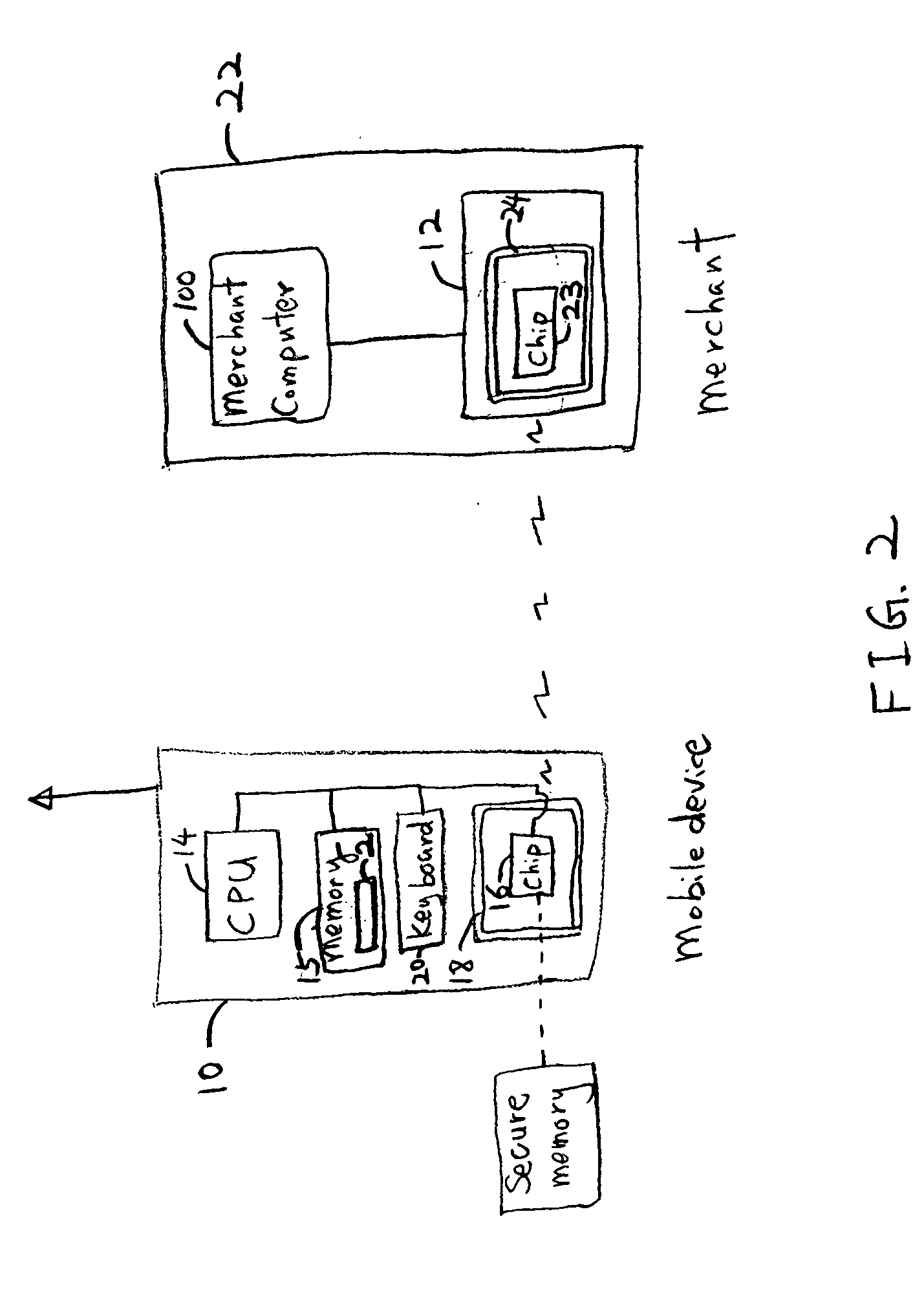

System and method of facilitating contactless payment transactions across different payment systems using a common mobile device acting as a stored value device

InactiveUS20050222961A1Convenient transactionSubstation equipmentCurrency conversionPayment transactionData exchange

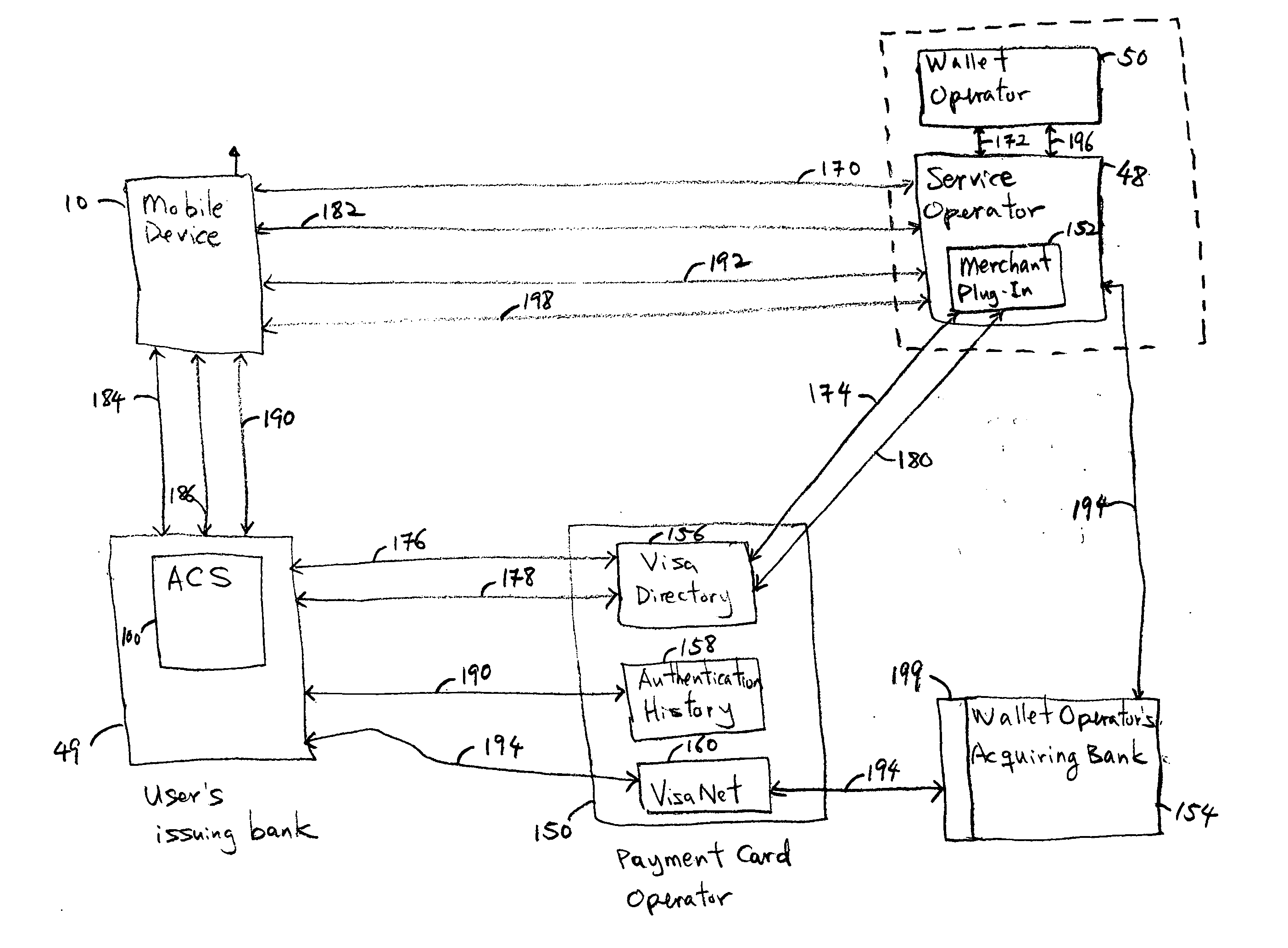

A system for facilitating contactless payment transactions across different contactless payment systems using a common mobile device that acts as a stored value device is provided. A combination of a mobile application and a communication module allows the mobile device, which is associated with one payment system, to emulate various transmission standards and data exchange formats that are used in different payment systems in order to perform contactless payment transactions with merchants that are associated with different contactless payment systems. A service application running in a service operator computer communicates with the various contactless payment systems to facilitate the settlement of the amount owed to various payment systems by the one payment system associated with the mobile device.

Owner:PAYZY CORP

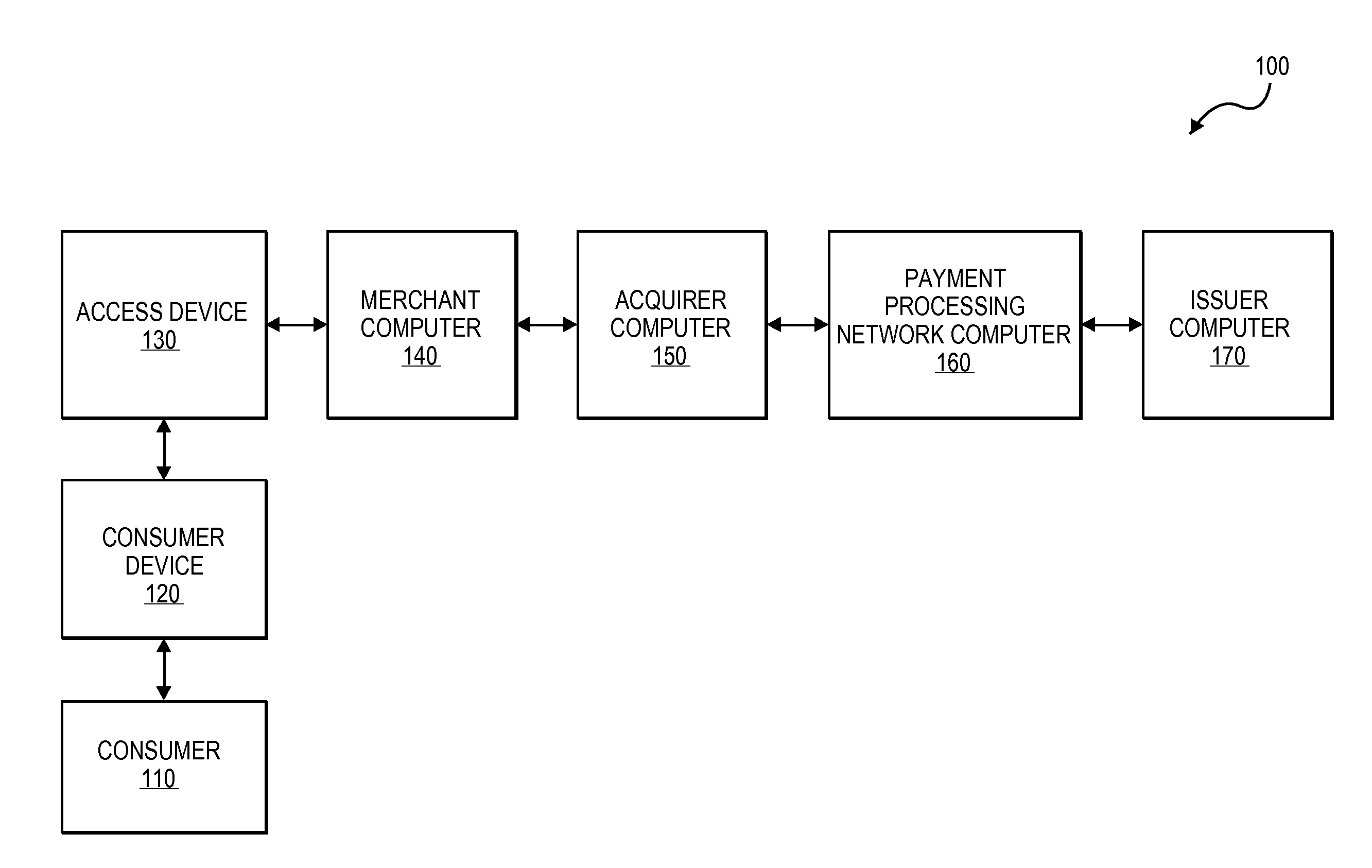

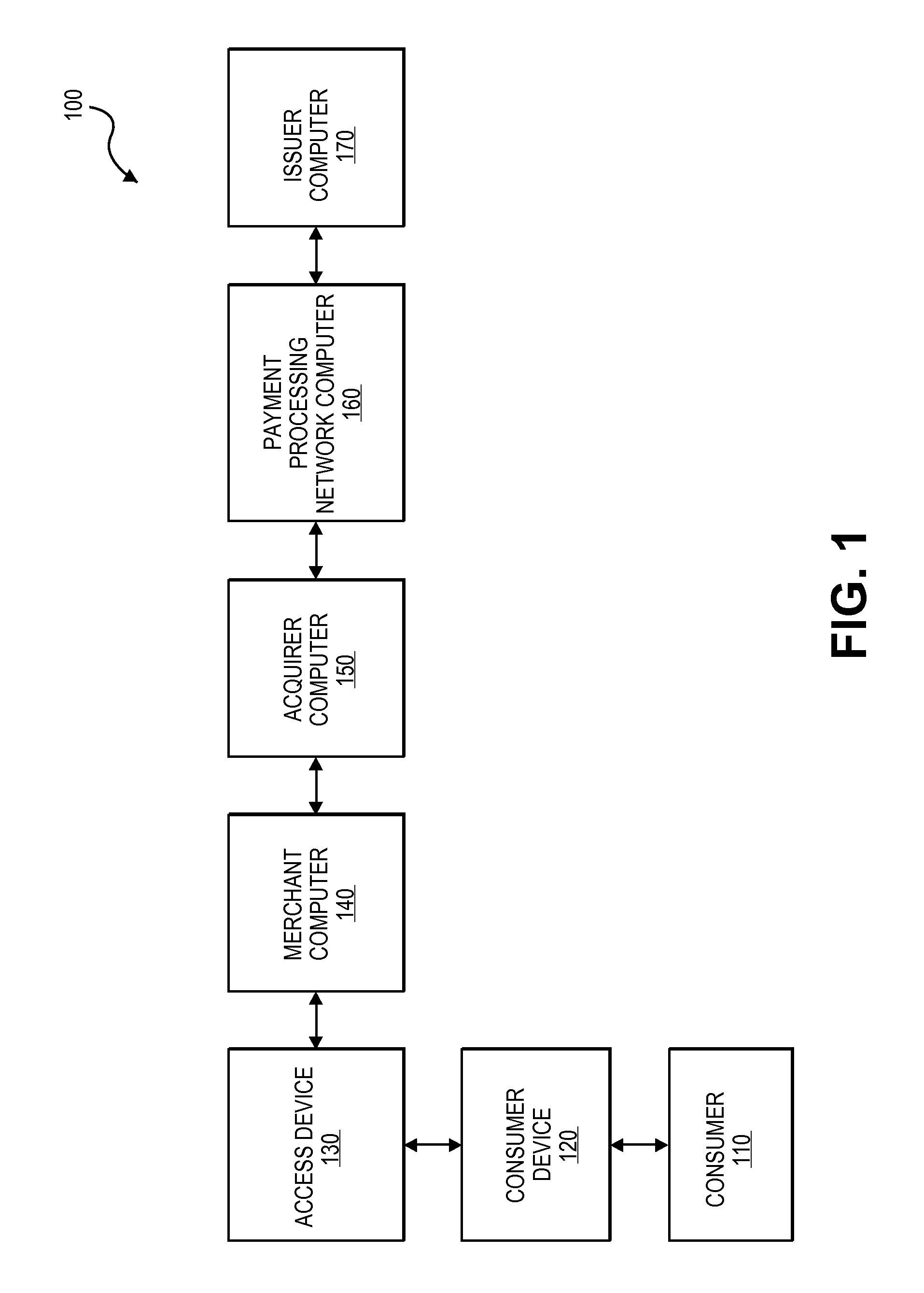

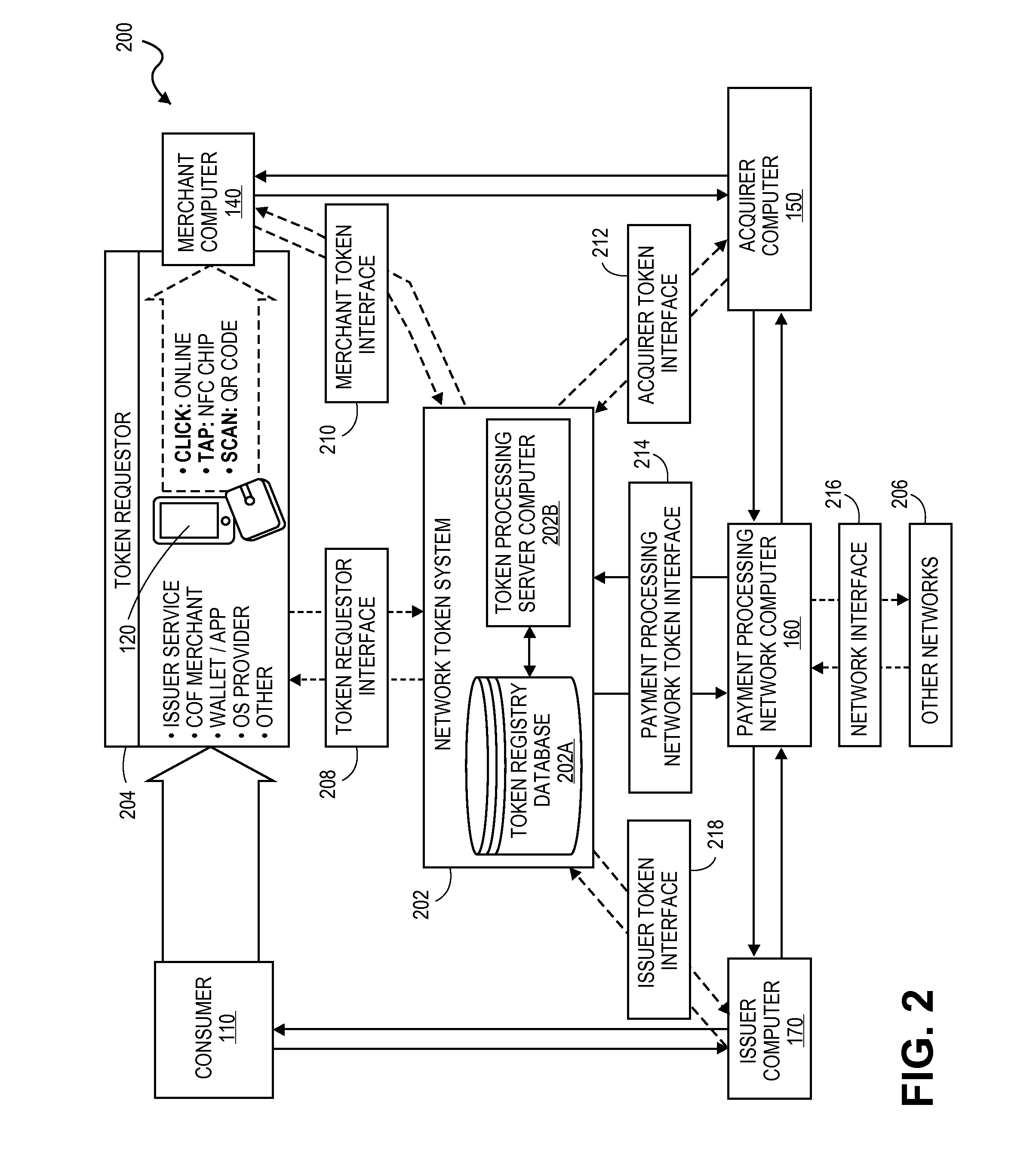

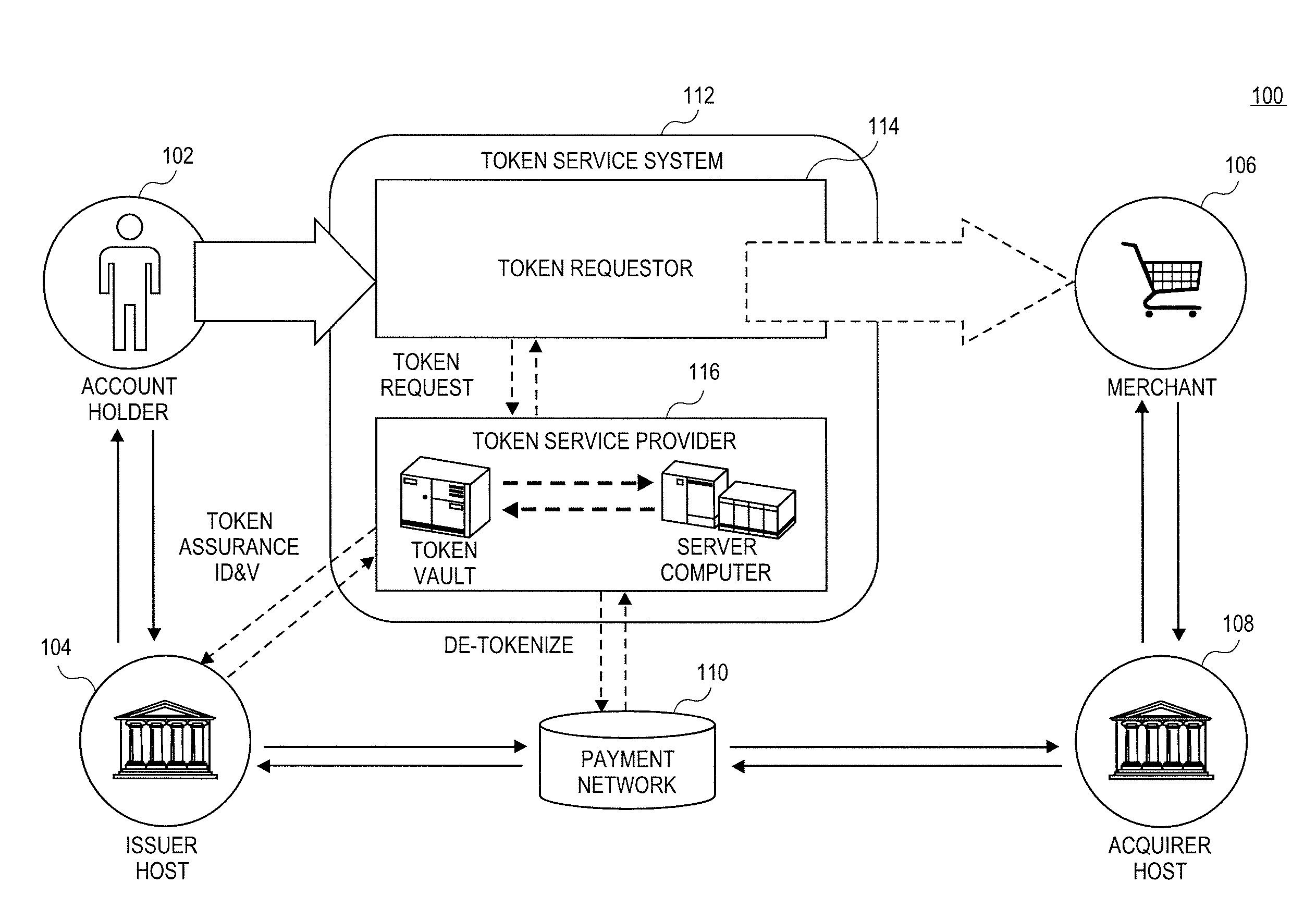

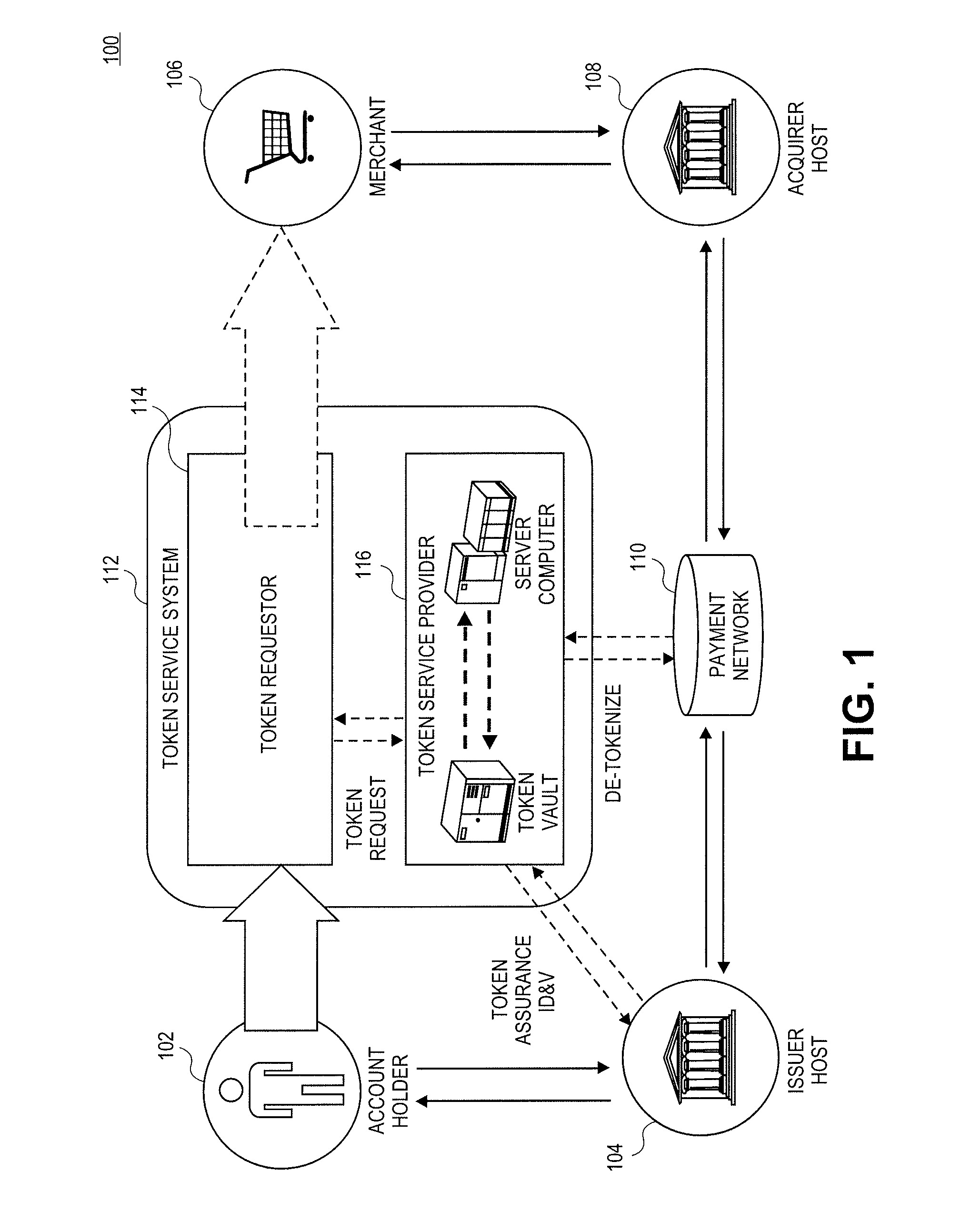

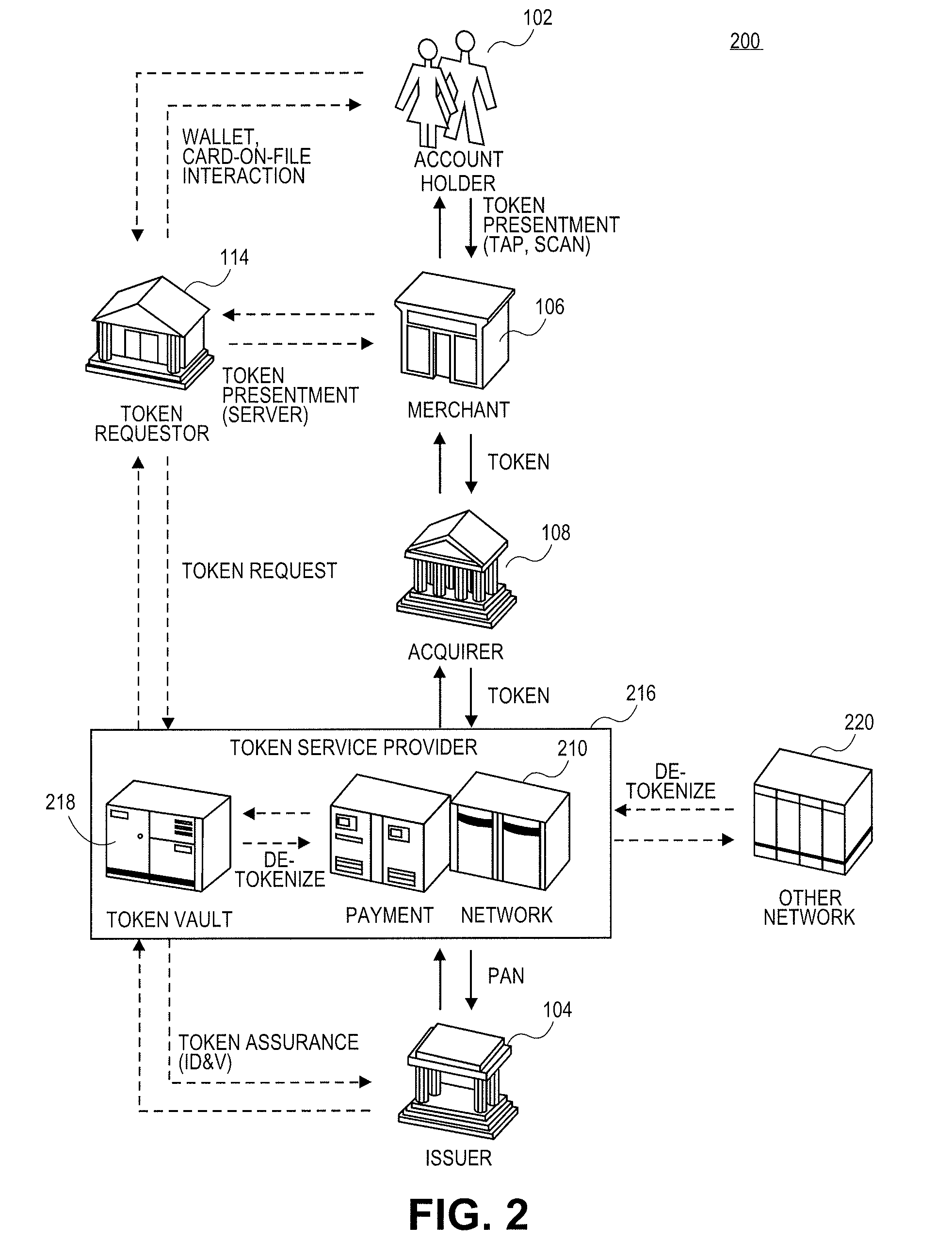

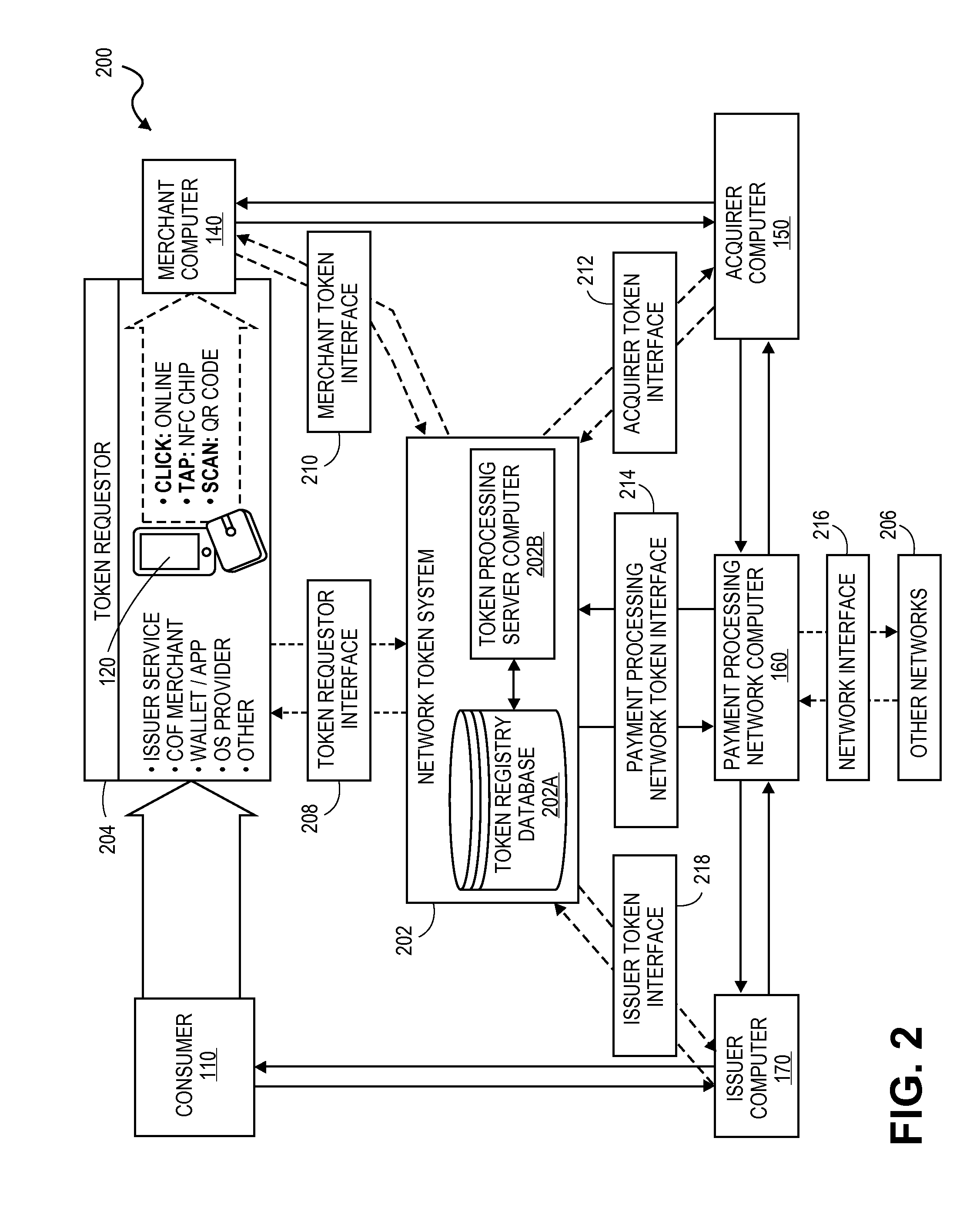

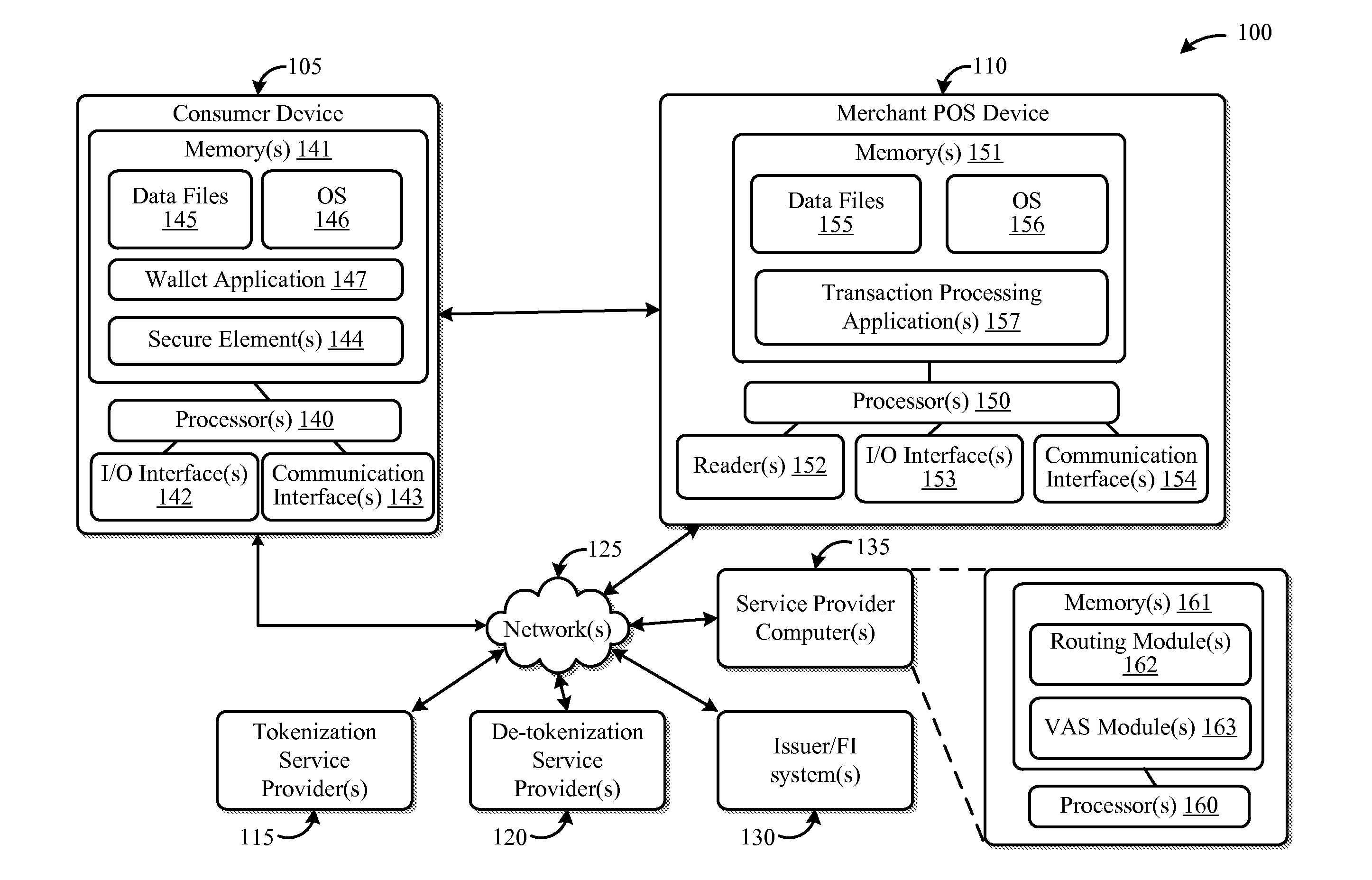

Systems and methods for communicating token attributes associated with a token vault

ActiveUS20150032627A1Convenient transactionSupported interoperabilityFinanceUser identity/authority verificationThird partyPayment transaction

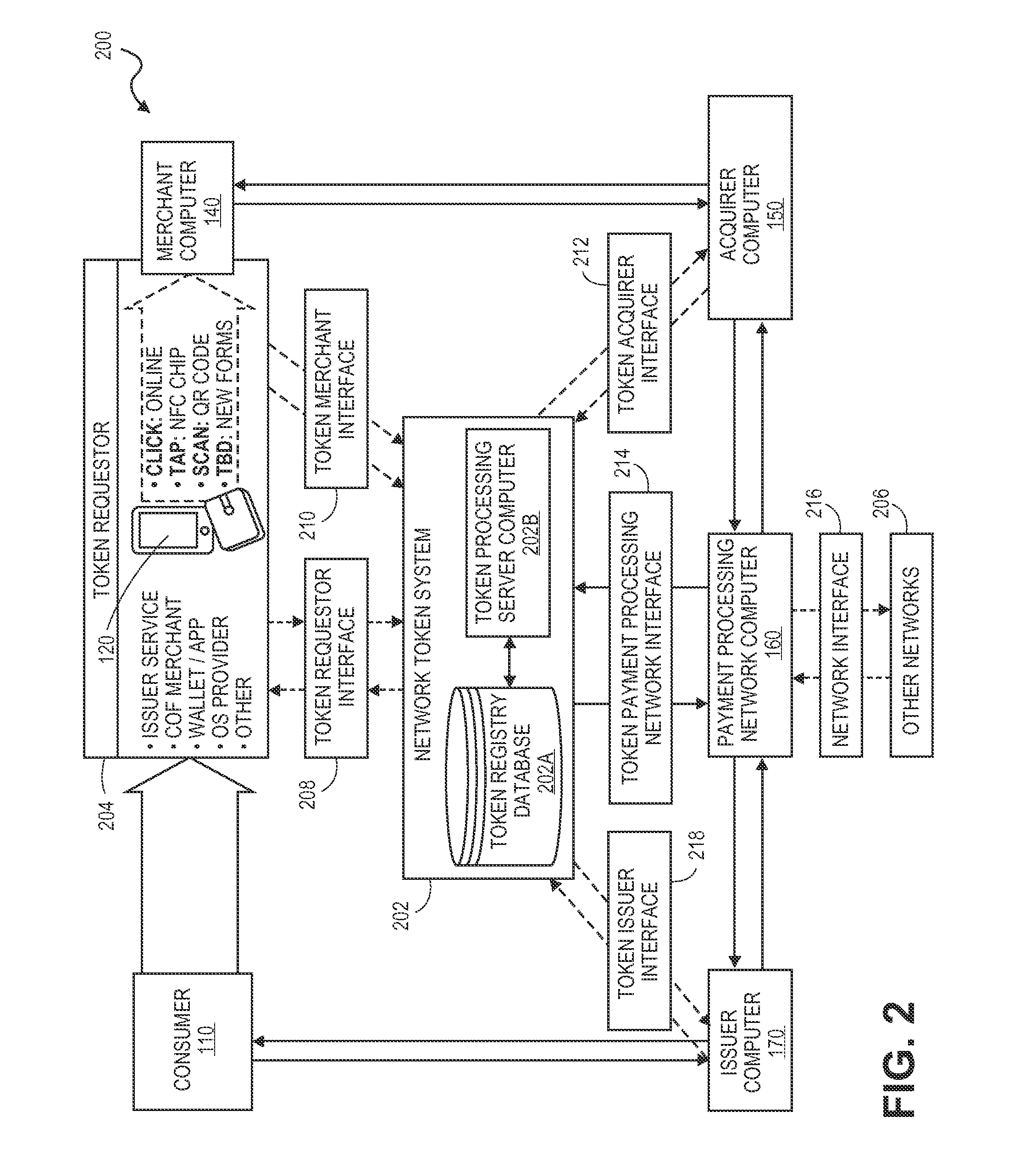

Systems and methods for interoperable network token processing are provided. A network token system provides a platform that can be leveraged by external entities (e.g., third party wallets, e-commerce merchants, payment enablers / payment service providers, etc.) or internal payment processing network systems that have the need to use the tokens to facilitate payment transactions. A token registry vault can provide interfaces for various token requestors (e.g., mobile device, issuers, merchants, mobile wallet providers, etc.), merchants, acquirers, issuers, and payment processing network systems to request generation, use and management of tokens. The network token system further provides services such as card registration, token generation, token issuance, token authentication and activation, token exchange, and token life-cycle management.

Owner:VISA INT SERVICE ASSOC

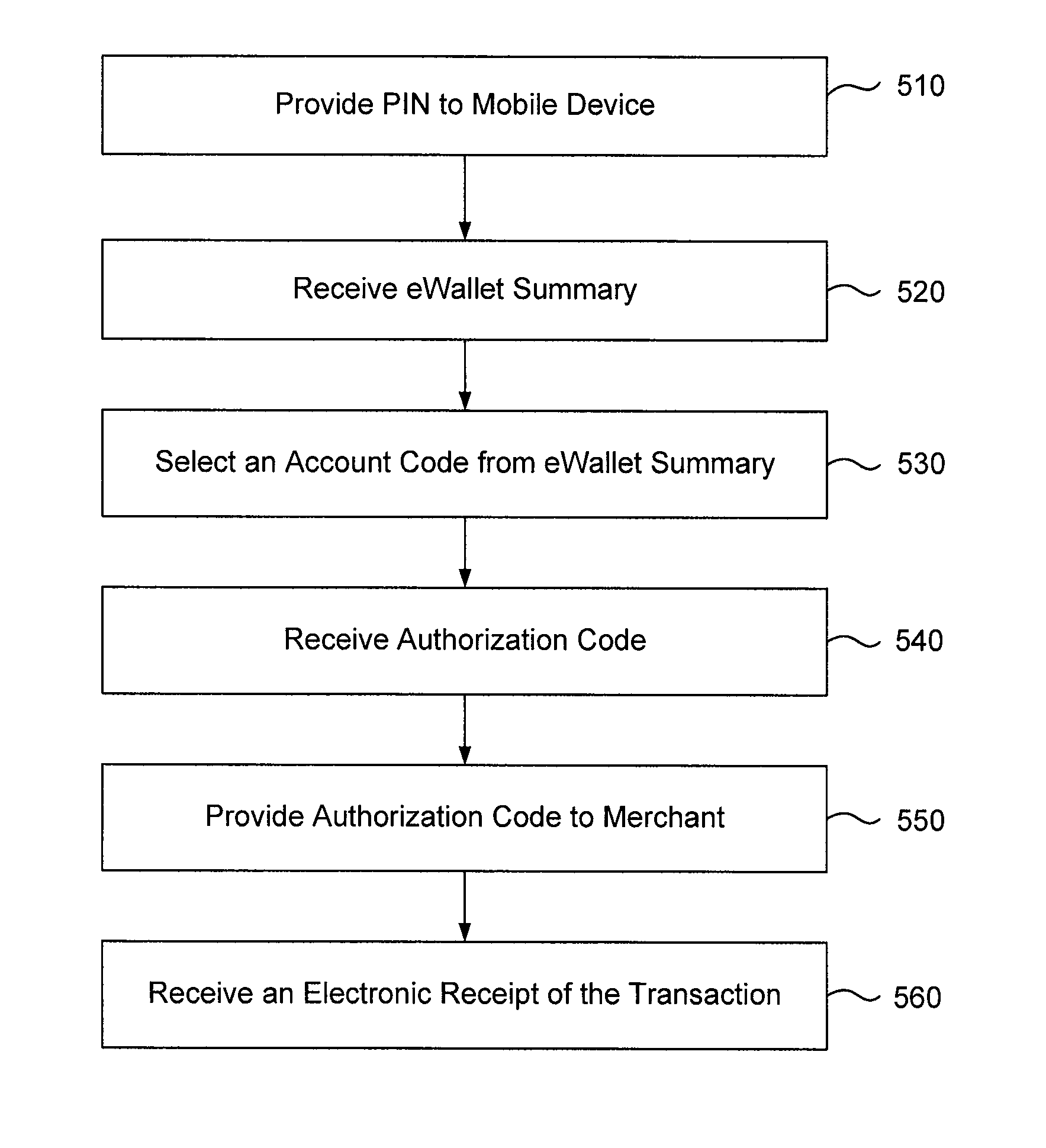

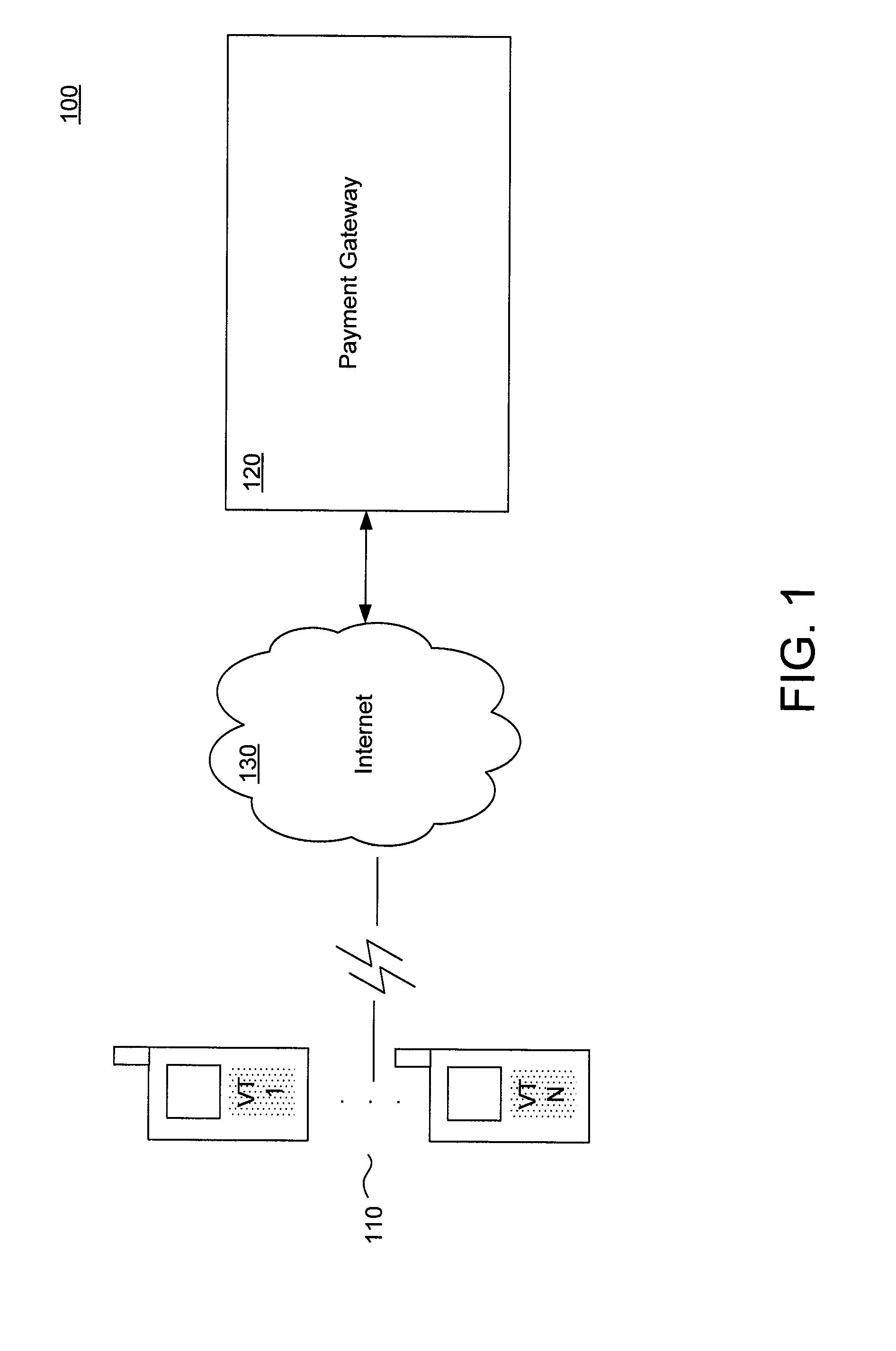

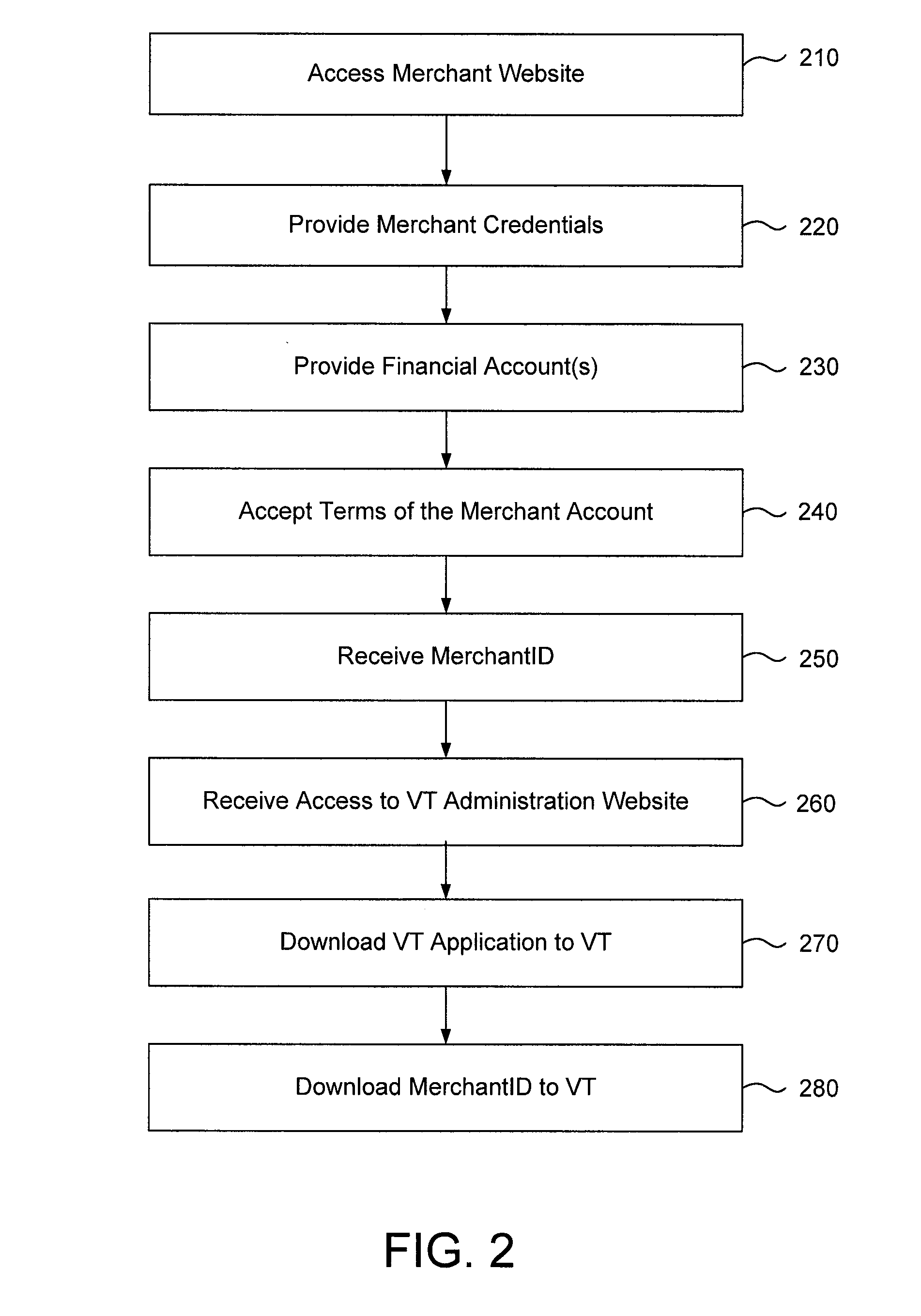

Method and System for Processing Secure Wireless Payment Transactions and for Providing a Virtual Terminal for Merchant Processing of Such Transactions

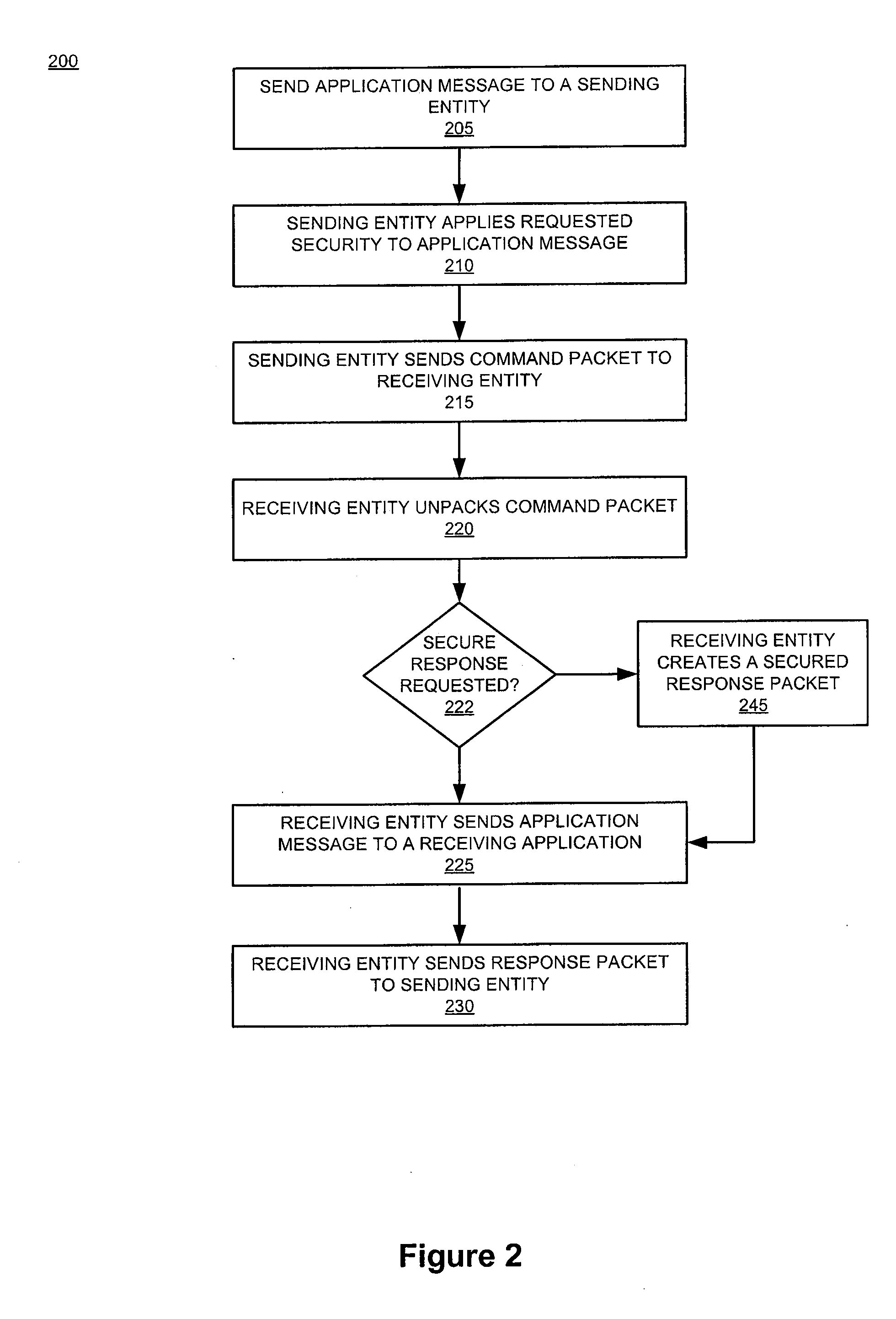

A system and method for processing a wireless electronic payment transaction is described. One embodiment comprises receiving a transaction authorization request for an electronic payment transaction from a customer, the authorization request submitted from a mobile communication device of the customer; authenticating the transaction authorization request; authorizing the transaction authorization request and transmitting an authorization code to the mobile communication device, the authorization code being communicated to a merchant from the customer; receiving a transaction approval request from the merchant, the transaction approval request submitted from a virtual terminal associated with the merchant, the virtual terminal being a wireless communication device having a point of sale processing application installed therein; authenticating the transaction approval request; approving the transaction approval request and transmitting an approval code to the virtual terminal; and generating and executing transaction settlement instructions between a financial account of the customer and a financial account of the merchant.

Owner:MOCAPAY

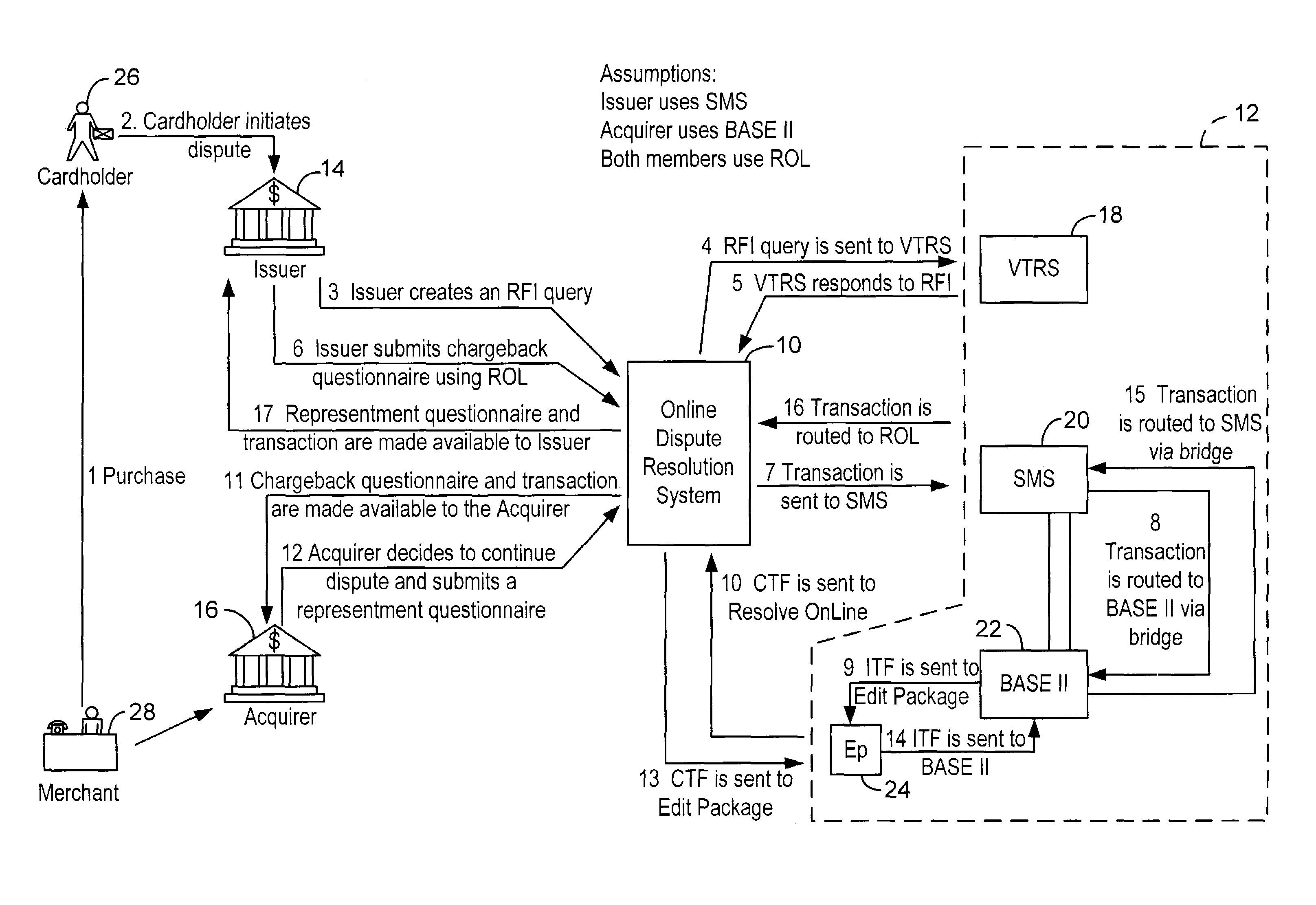

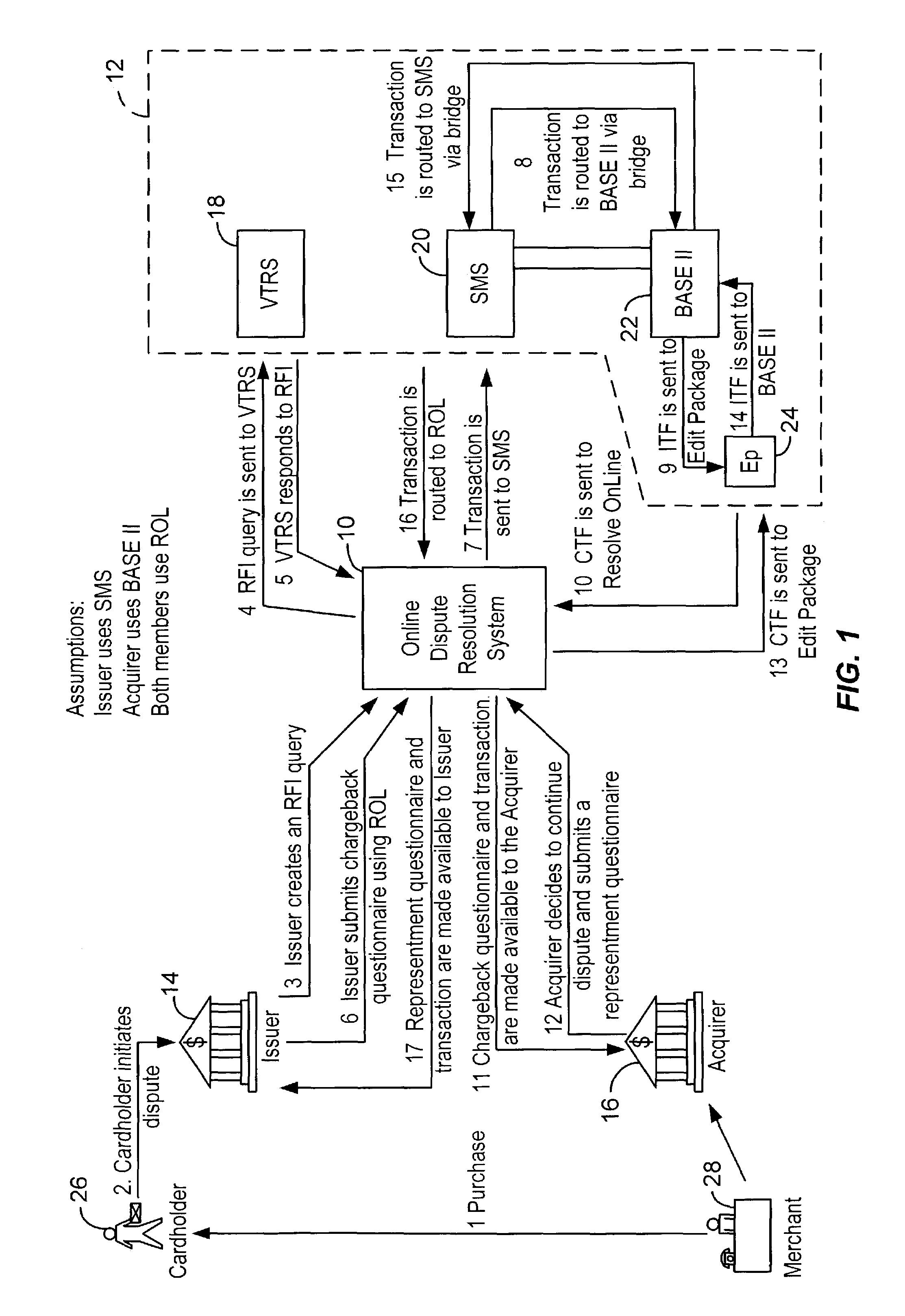

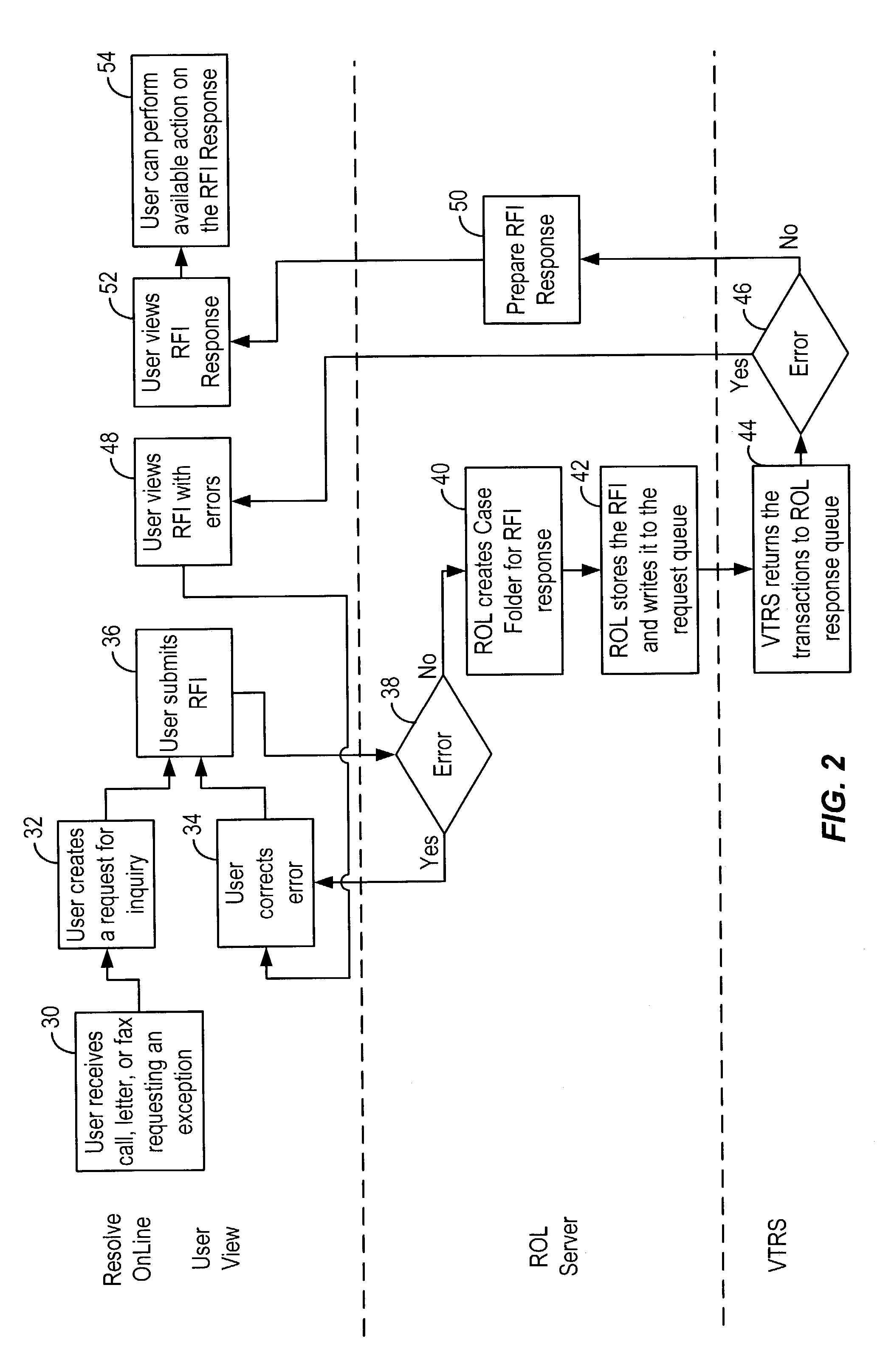

Method and system for facilitating electronic dispute resolution

A system for facilitating payment transaction disputes is provided. According to one aspect of the system, a user, such as an issuer, is allowed to use the system to resolve a disputed transaction. Based on information provided by a cardholder, the issuer is able to use the system to retrieve transactional information relating to the disputed transaction reported by the customer for review. When the issuer uses the system to retrieve information relating to the disputed transaction, a case folder is created. The case folder is a repository for storing all the relevant information and documentation relating to the disputed transaction. Using the information retrieved by the system, the issuer then determines whether to initiate a dispute. Alternatively, the system can also be used by an acquirer to respond to a dispute, usually on behalf of one of its merchant. If a dispute is responded to, a questionnaire is then created by the system. Alternatively, the issuer may decline to initiate a dispute and either seek additional information from the cardholder or deny the cardholder's inquiry. The case folder and the questionnaire are created for a specific disputed transaction. The questionnaire is designed to capture information from the cardholder and / or the issuer relating to the disputed transaction. The questionnaire may be pre-populated with previously retrieved transactional information which is stored in the case folder. Relevant documents in support of the disputed transaction may also be attached as part of the questionnaire. Various parties to the dispute may then provide relevant information (including supporting documentation) to the system. The relevant information provided by the parties is maintained in the case folder. The system then keeps track of the relevant timeframes for the case folder to ensure that each party to the dispute is given the correct period of time to respond during the processing of a dispute. Prior to filing the dispute for arbitration or compliance, the system permits the parties to resolve the dispute amongst themselves without the help of an arbiter through pre-arbitration and pre-compliance. If the parties to the dispute are unable to resolve the dispute on their own, the system also permits the parties to resolve the dispute via arbitration or compliance with the help of an arbiter. The system provides the arbiter with access to the case folder to allow the arbiter to render an informed decision on the dispute.

Owner:VISA USA INC (US)

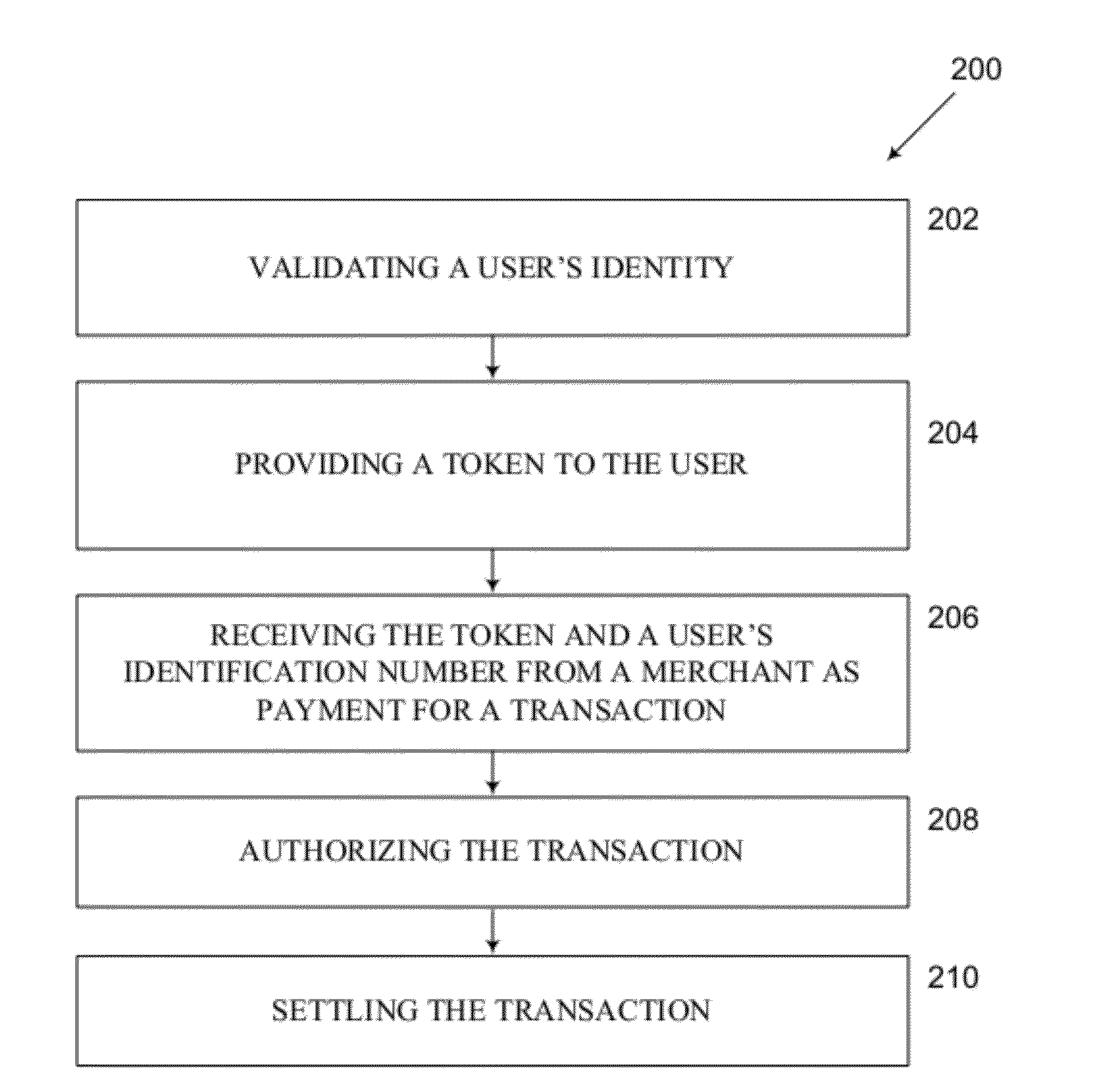

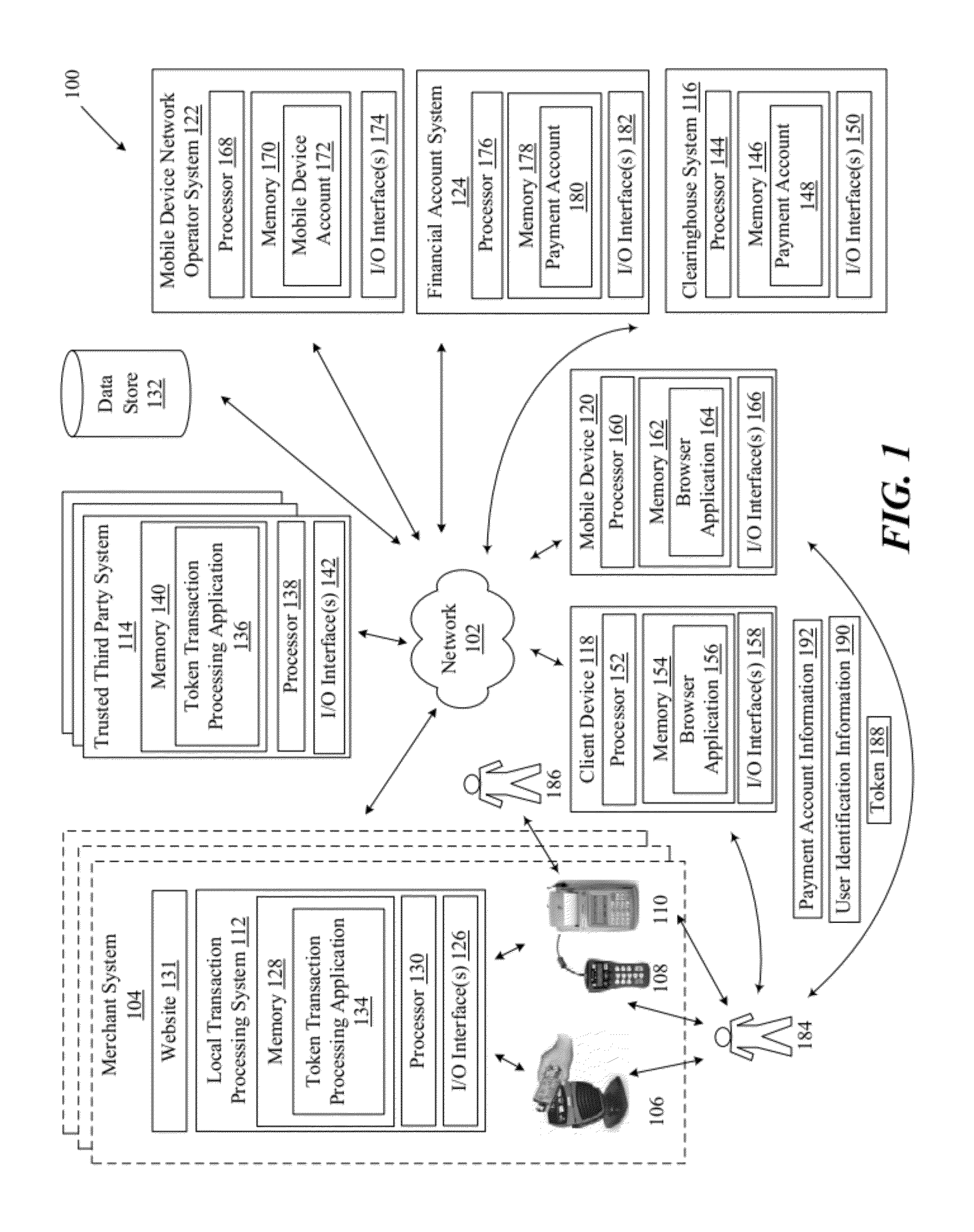

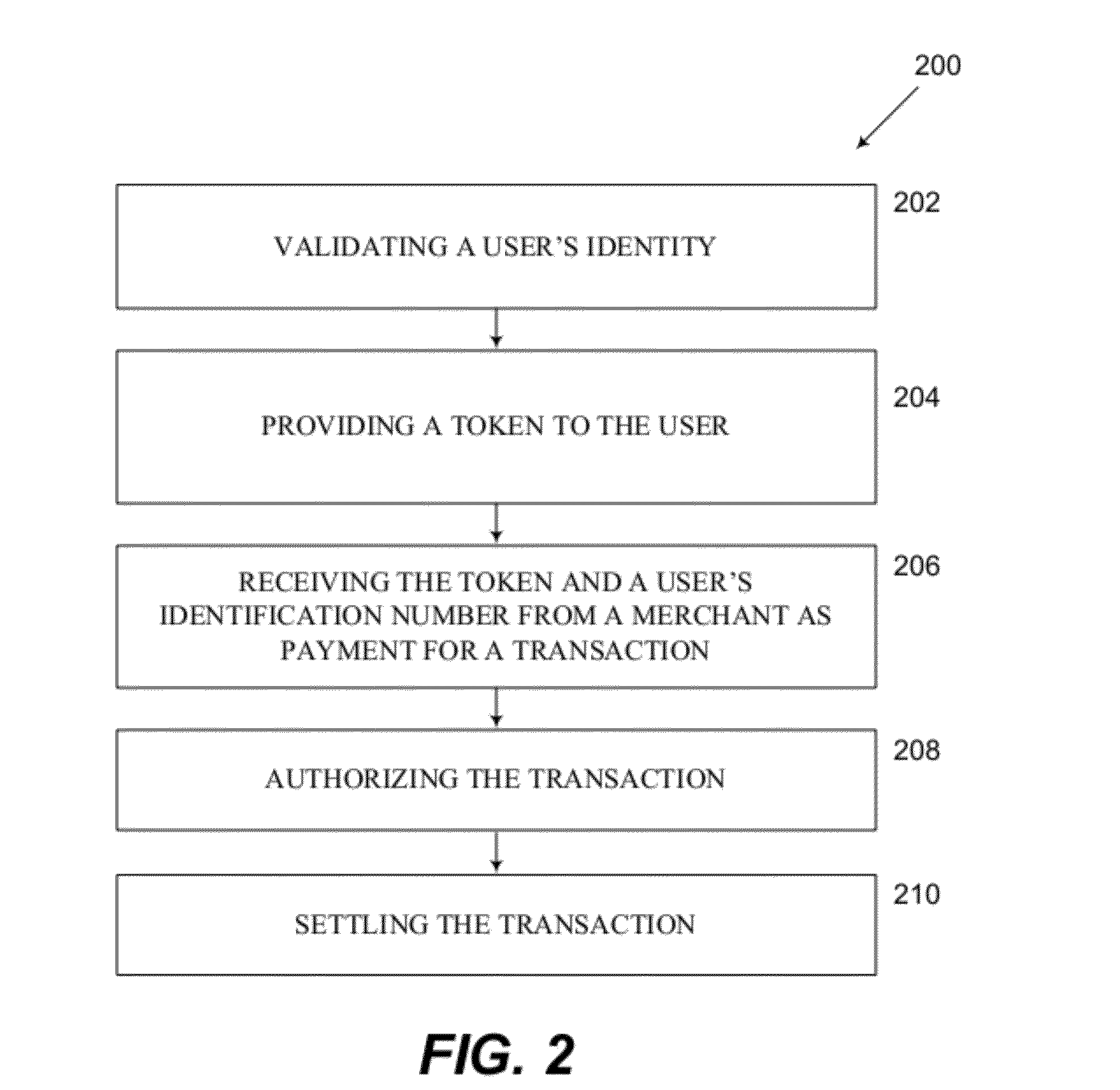

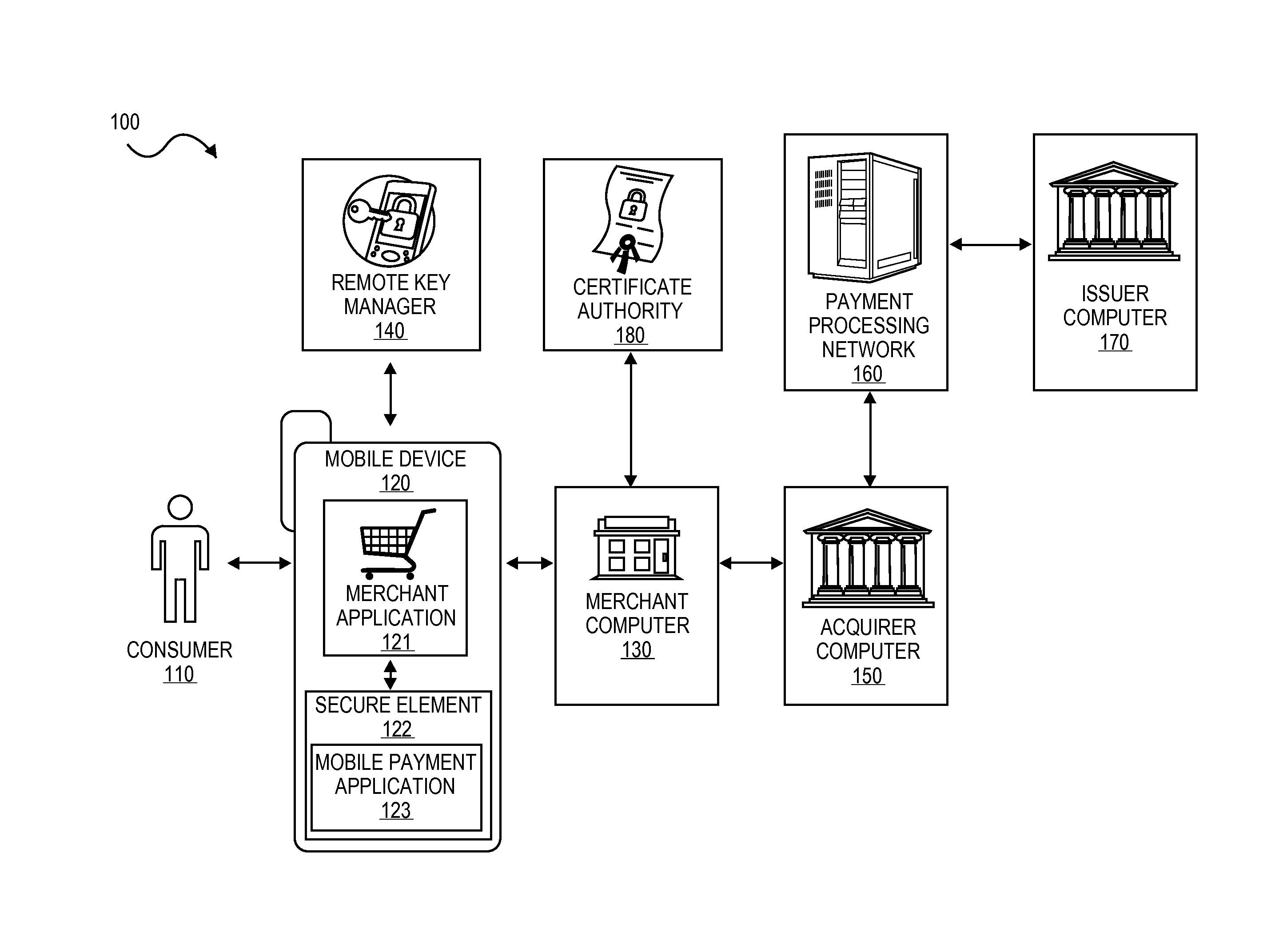

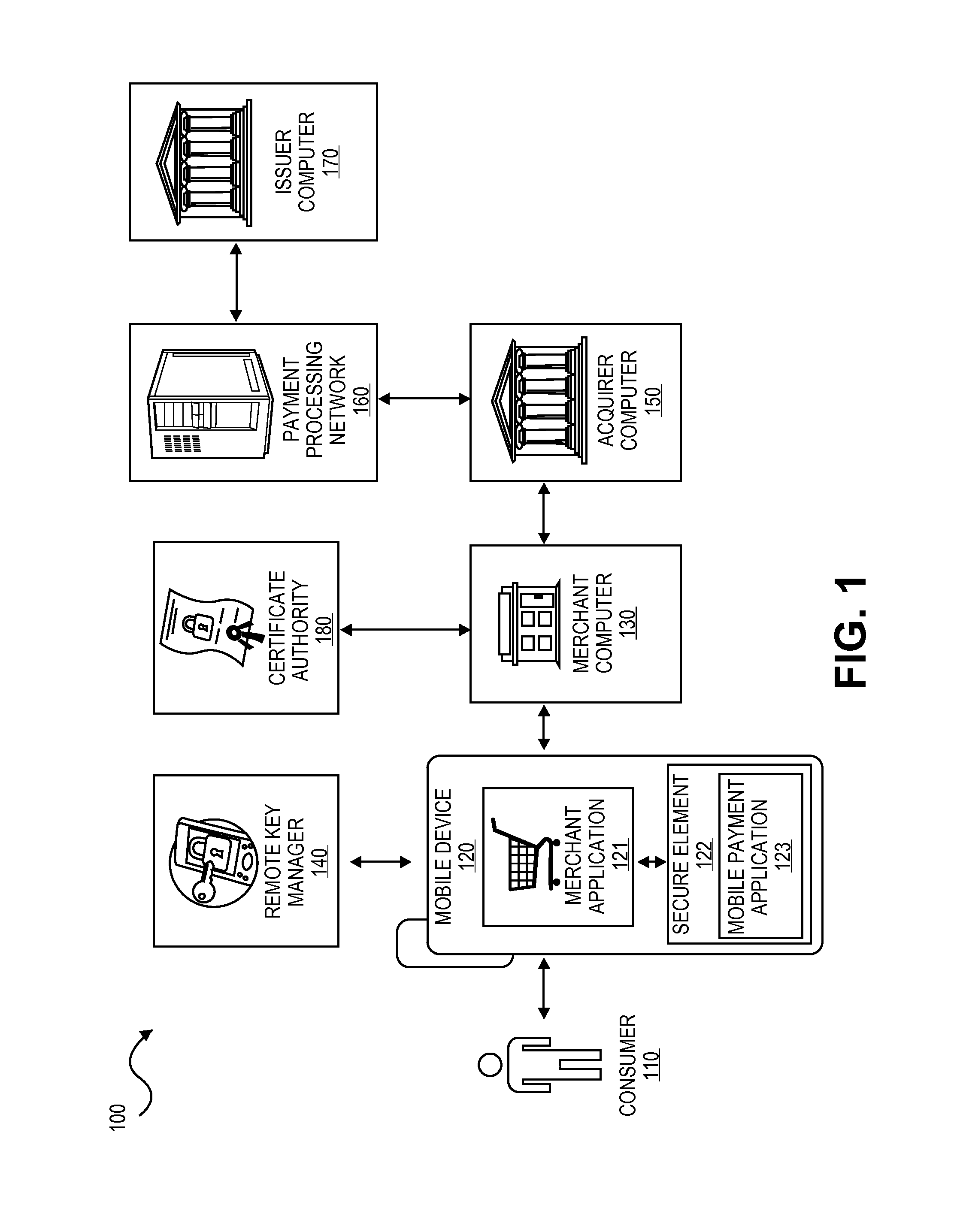

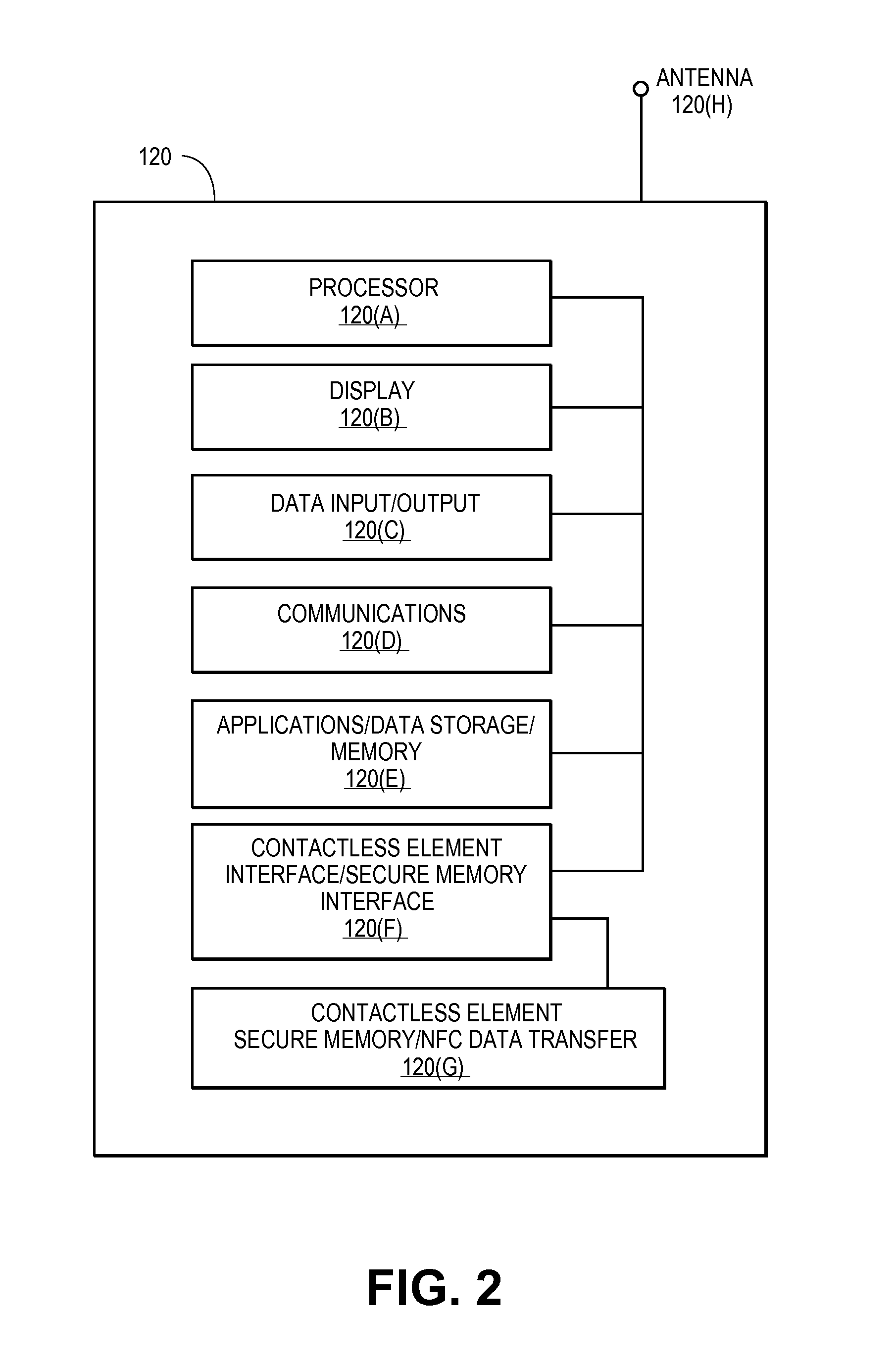

Systems and methods for using a token as a payment in a transaction

Embodiments of the invention relate to systems and methods for using a token as a payment in a transaction. In one embodiment, a method for facilitating a payment transaction using a mobile device can be provided. The method can include validating a user's identity; providing a token to the user; receiving the token and user identification information from a merchant as payment for a transaction; and authorizing the transaction.

Owner:FIRST DATA

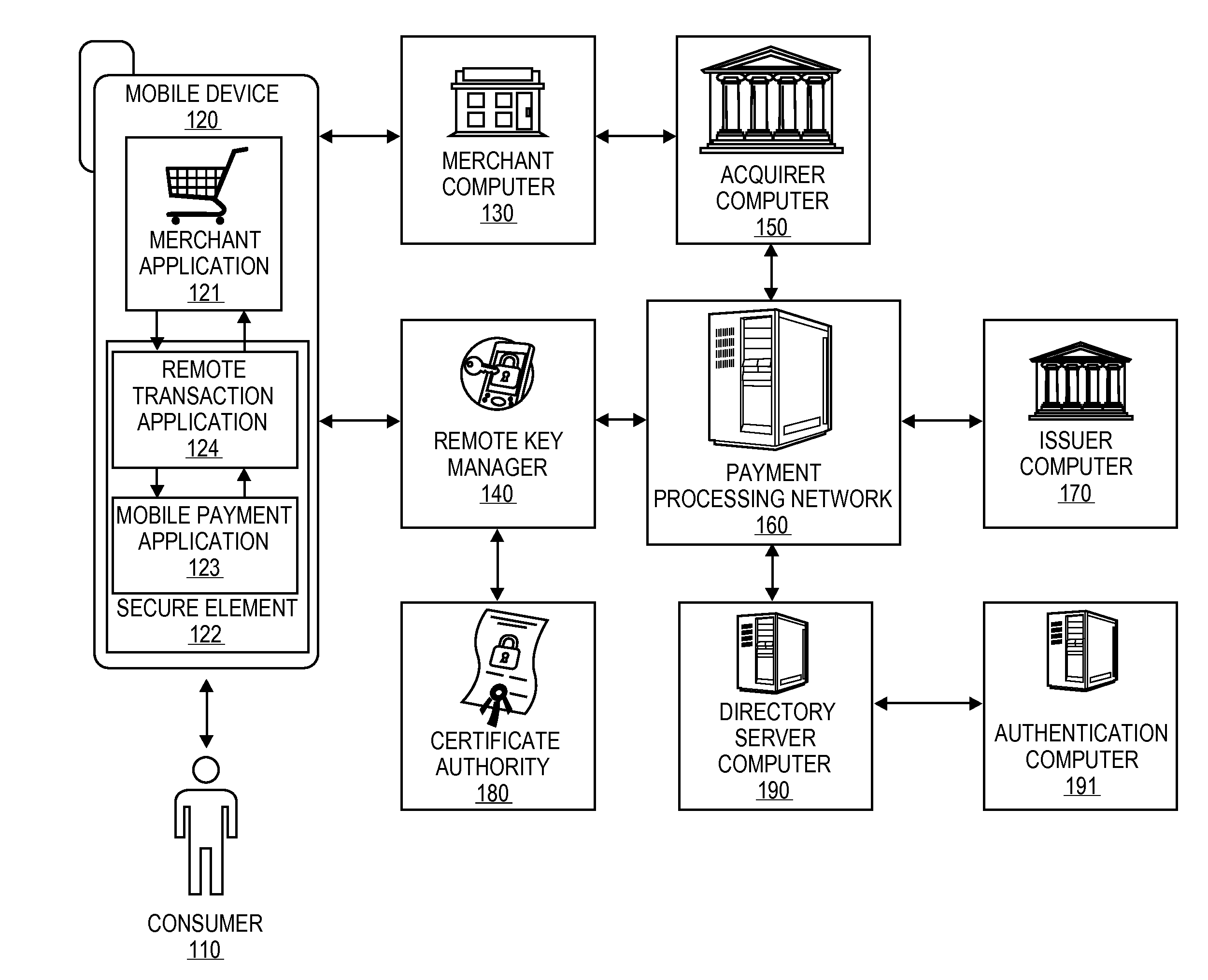

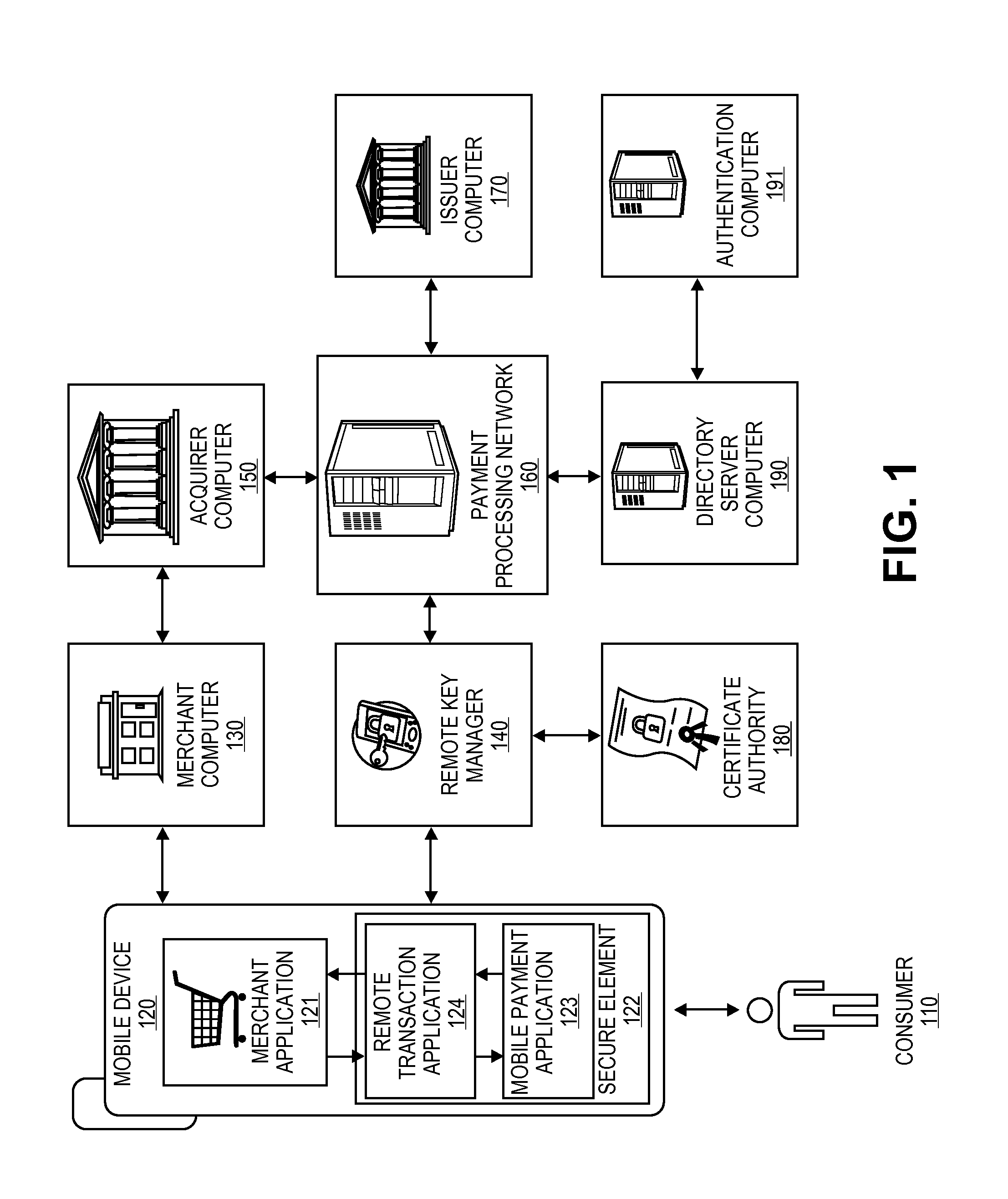

Secure remote payment transaction processing

ActiveUS20150019443A1Improve security levelImprove securityProtocol authorisationThird partyPayment transaction

Embodiments of the present invention are directed to methods, apparatuses, computer readable media and systems for securely processing remote transactions. One embodiment of the invention is directed to a method of processing a remote transaction initiated by a mobile device comprising a server computer receiving a payment request including encrypted payment information. The encrypted payment information being generated by a mobile payment application of the mobile device and being encrypted using a third party key. The method further comprises decrypting the encrypted payment information using the third party key, determining a transaction processor public key associated with the payment information, and re-encrypting the payment information using the transaction processor public key. The method further comprises sending a payment response including the re-encrypted payment information to a transaction processor. The transaction processor decrypts the re-encrypted payment information using a transaction processor private key and initiates a payment transaction.

Owner:VISA INT SERVICE ASSOC

Systems and methods for communicating risk using token assurance data

InactiveUS20150032625A1Easy to optimizeFinanceUser identity/authority verificationThird partyPayment transaction

Systems and methods for communicating risk using token assurance data are provided. A network token system provides a platform that can be leveraged by external entities (e.g., third party wallets, e-commerce merchants, payment enablers / payment service providers, etc.) or internal payment processing network systems that have the need to use the tokens to facilitate payment transactions. An authorization request message can include a token assurance level code that is indicative of a token assurance level associated with a generated token. External or internal entities may use the token assurance level to evaluate risk associated with a payment transaction that uses the token.

Owner:VISA INT SERVICE ASSOC

System and device for facilitating a transaction by consolidating sim, personal token, and associated applications for electronic wallet transactions

InactiveUS20120231844A1Increase dependenceFacilitating secure and convenient electronic transactionsPayment architectureSubstation equipmentPayment transactionSmart card

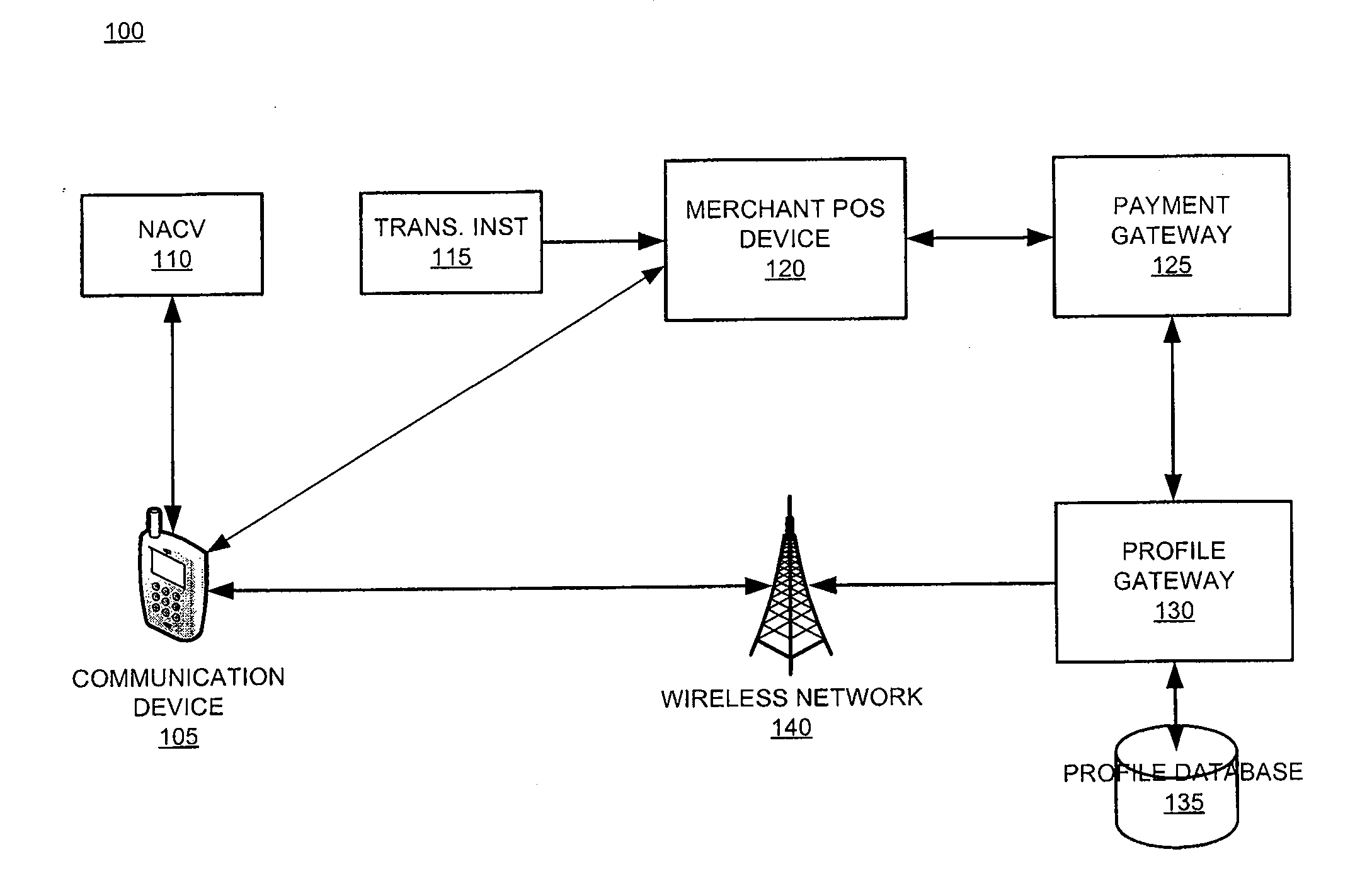

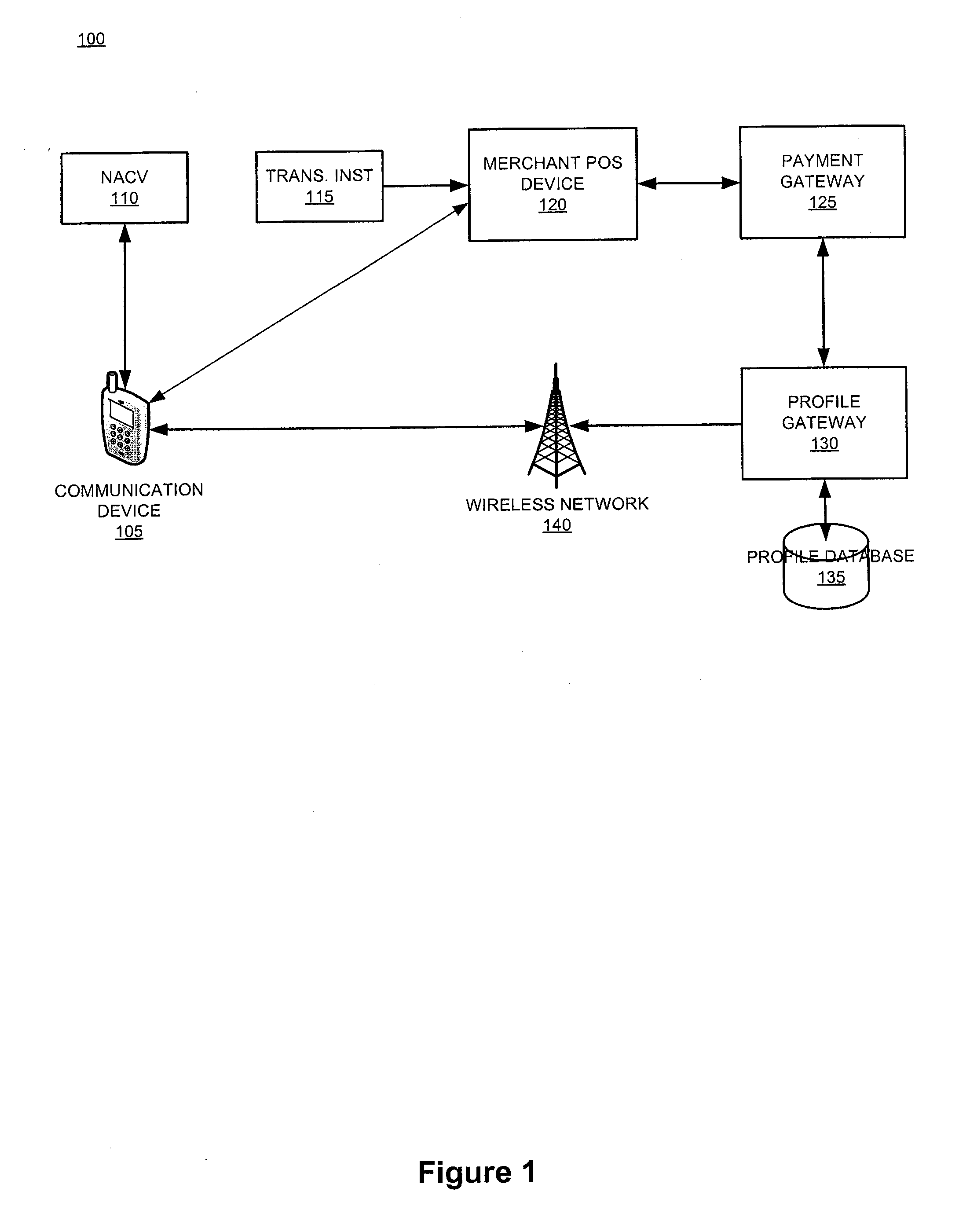

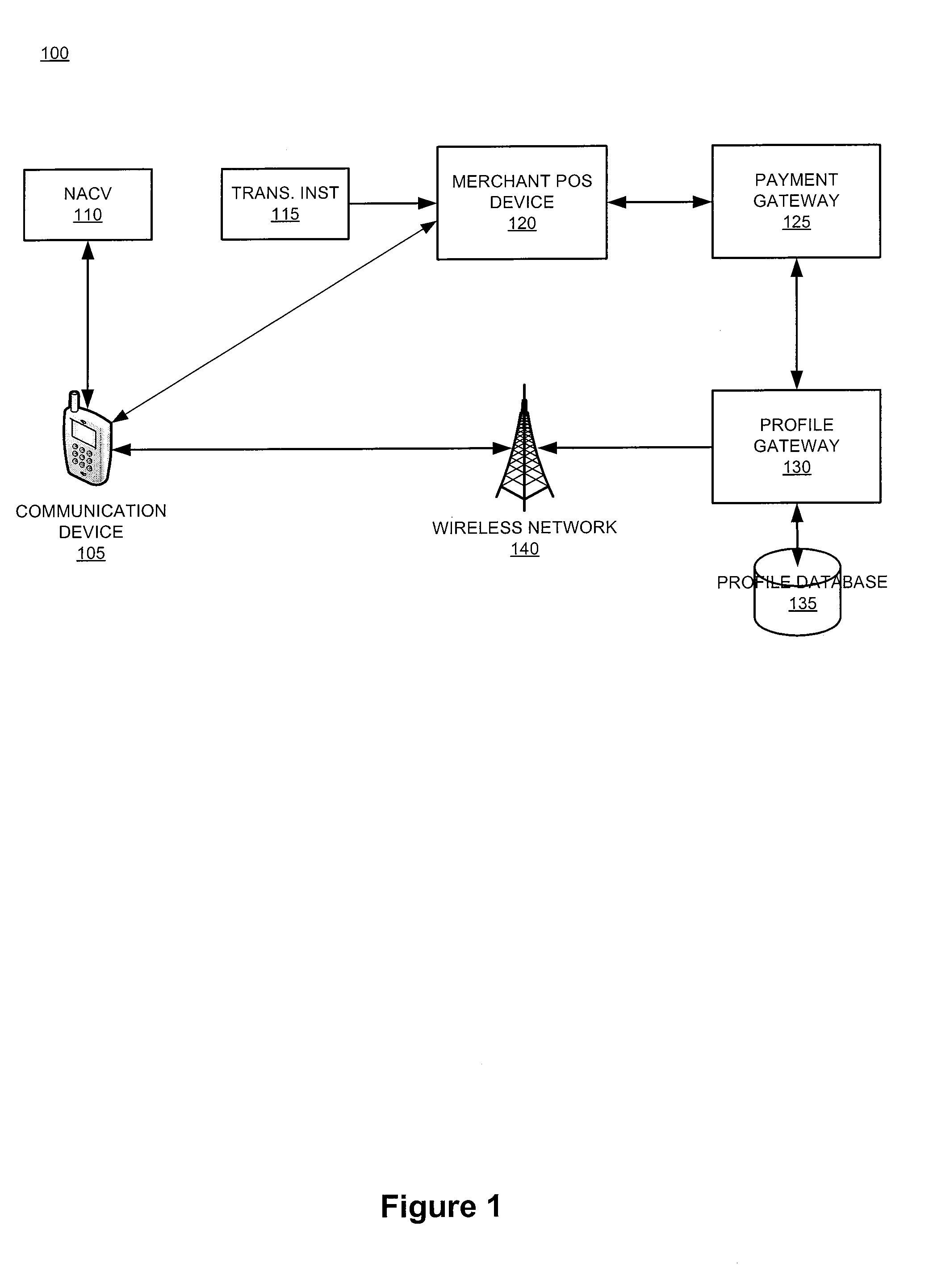

The invention relates generally to a smart card device that is configured to facilitate wireless network access and credential verification. Specifically, the device is configured to meet the physical and electrical specification for commercially available mobile devices utilizing a standard Subscriber Identity Module (SIM) for network access. The device combines the features of the SIM with Common Access Card or Personal Identity Verification card features to allow a network subscriber to invoke secure payment transactions over a carrier's network. The system includes data storage for maintaining a plurality of network and transaction instrument profiles and a profile gateway for receiving transaction information from a payment gateway, sending an authorization request to a user's mobile device, receiving a transaction authorization from the mobile device, and sending transaction information to a payment gateway to finalize the payment transaction.

Owner:APRIVA

Methods and Systems For Payment Transactions in a Mobile Environment

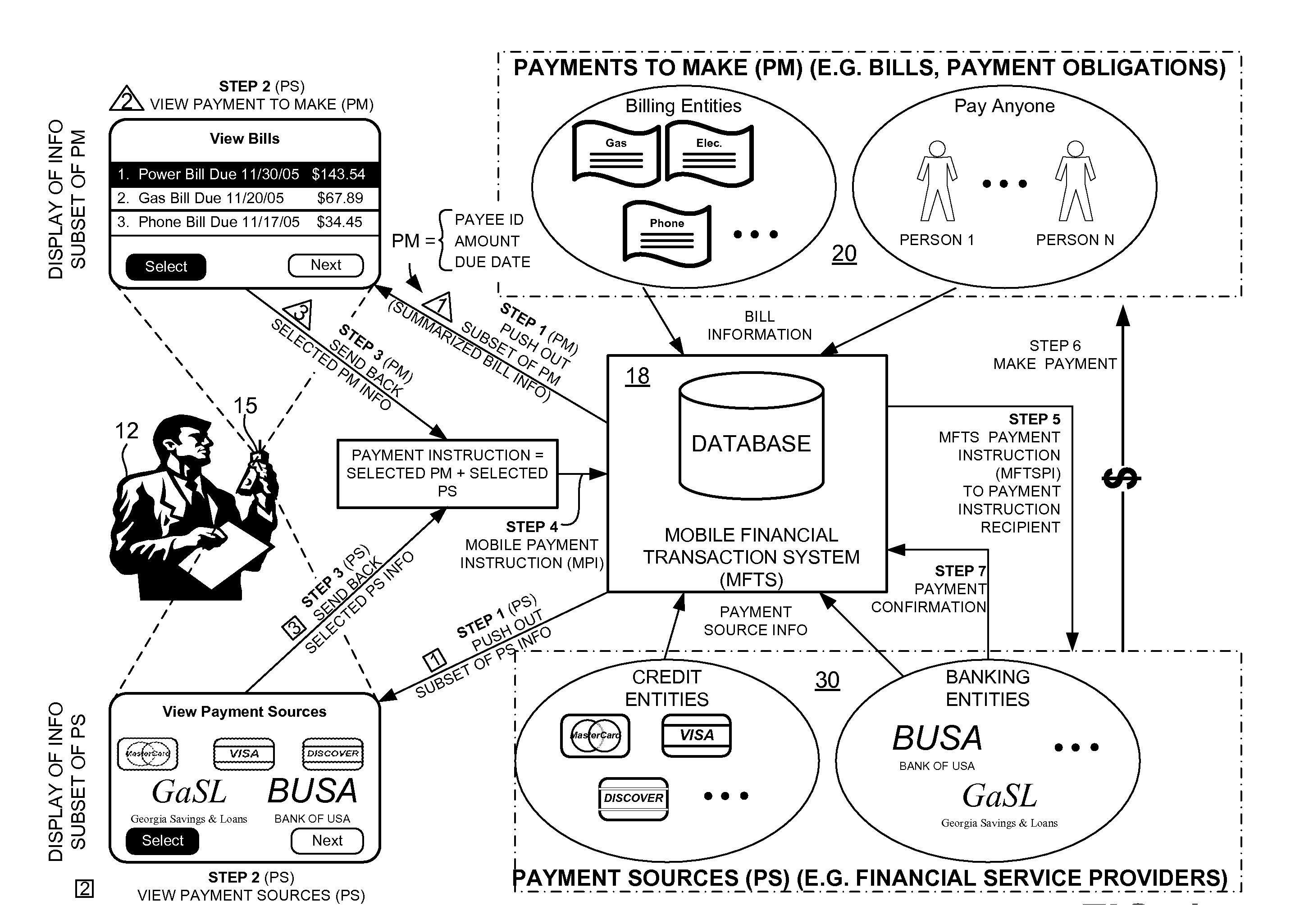

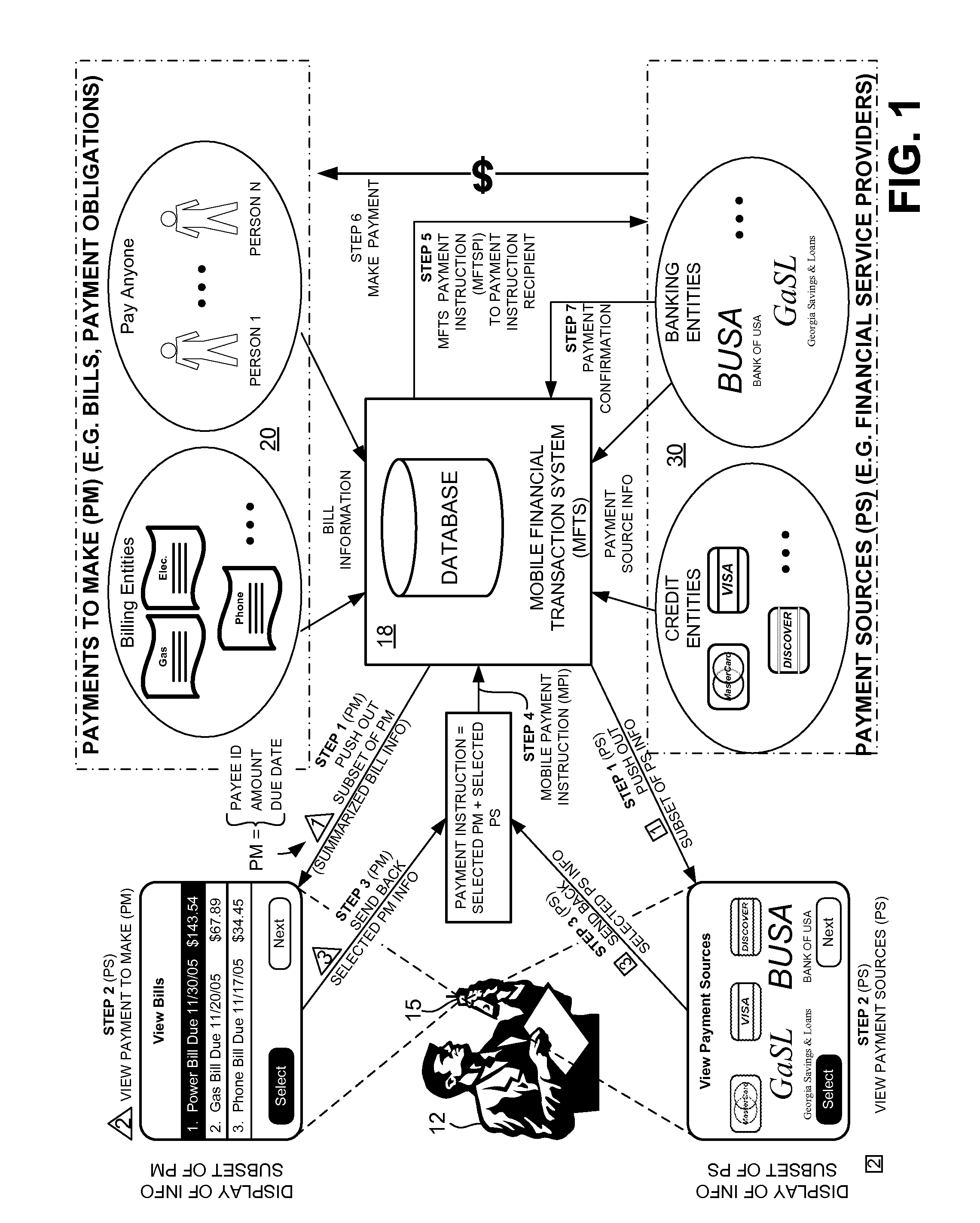

ActiveUS20080010190A1Unprecedented convenienceUnprecedented flexibilityFinancePayment architecturePayment transactionFinancial transaction

Methods and systems for conducting financial transactions in a mobile environment utilizing a mobile device such as a mobile telephone or wireless connected personal digital assistant (PDA) that communicates with a mobile financial transaction system (MFTS) that stores user and transaction information. The MFTS receives information on behalf of a mobile device user corresponding to bills to pay or other payments to make. The MFTS also receives information corresponding to payment sources available for use in making payments. Selected payments information and payment source information are communicated to the mobile user via a wireless network and displayed for user selection. The user selects a payment to make and a payment source. A mobile payment instruction is generated and communicated to the MFTS. The MFTS instructs a payment instruction recipient to make a payment to an identified payee. Real-time updated account and payment balances are provided to the user's mobile device.

Owner:QUALCOMM INC

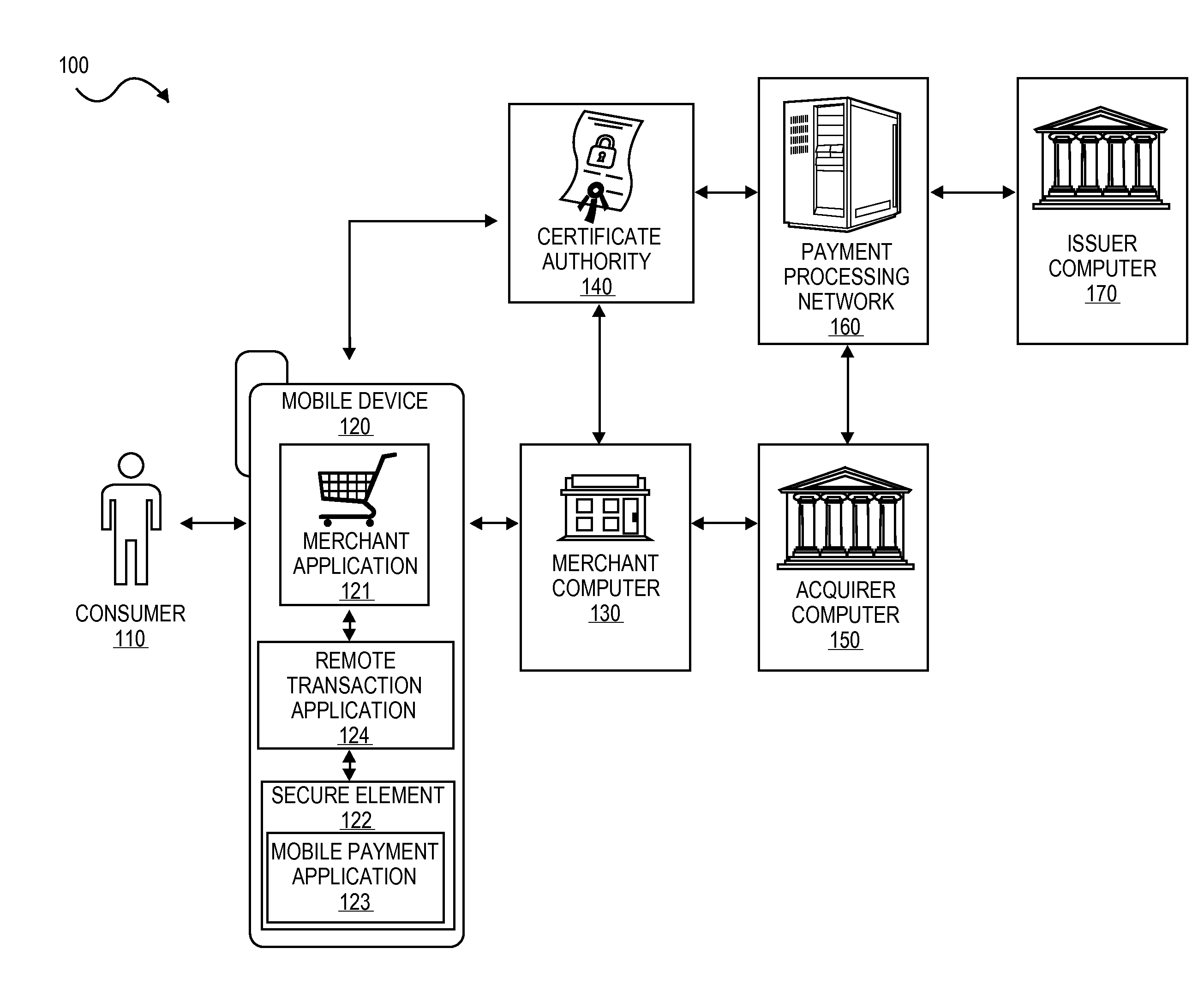

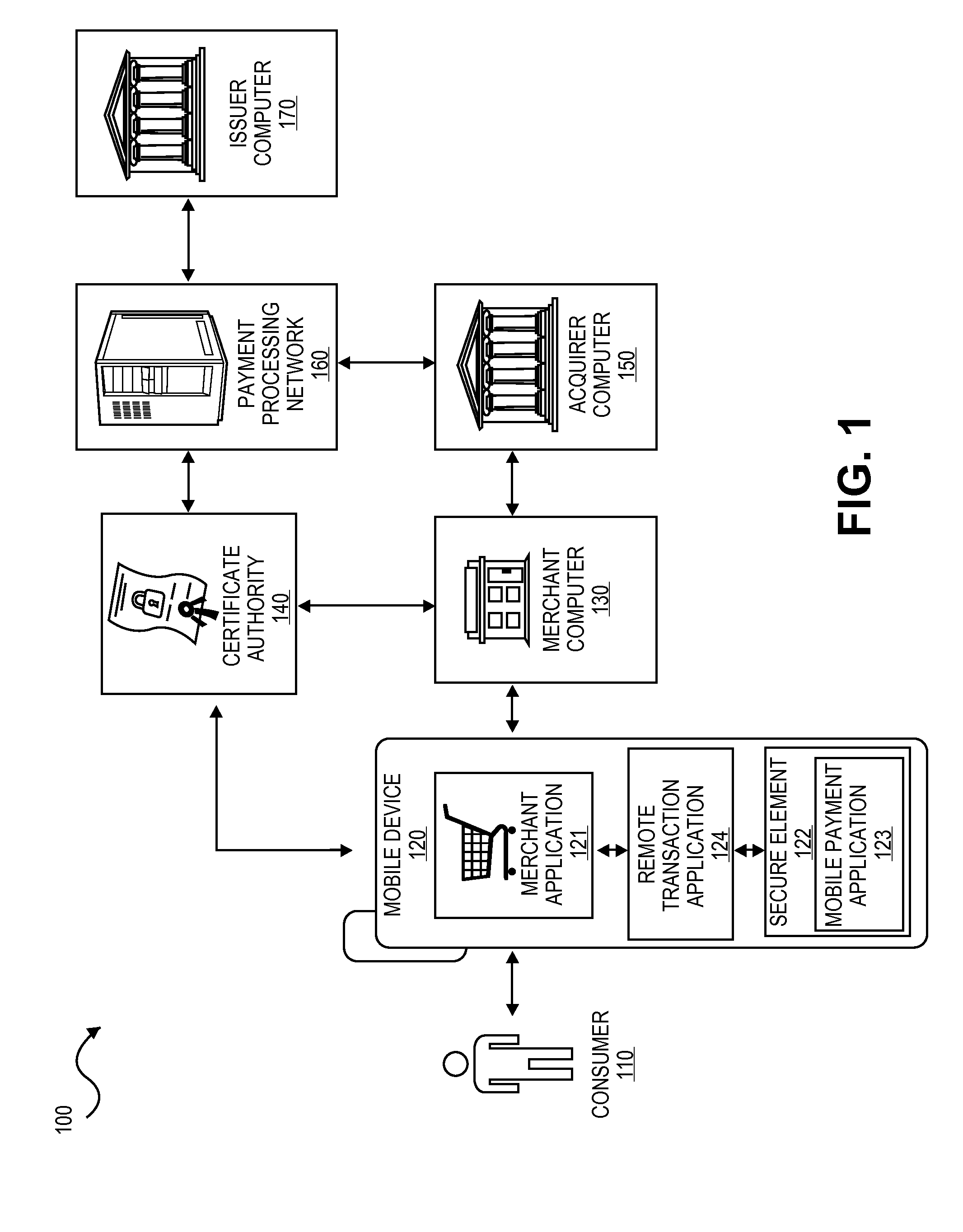

Secure Remote Payment Transaction Processing Including Consumer Authentication

ActiveUS20150088756A1Improve security levelProtocol authorisationPayment transactionEncryption decryption

Embodiments of the invention are directed to methods, apparatuses, computer-readable media, and systems for securely processing remote transactions. One embodiment is directed to a method of processing a remote transaction initiated by a communication device. The method comprising a server computer receiving a payment request including encrypted payment information that is encrypted using a first key. The encrypted payment information including security information. The method further comprises decrypting the encrypted payment information using a second key, obtaining an authentication response value for the remote transaction from an authentication computer associated with an issuer, updating the decrypted payment information to include the authentication response value, re-encrypting the decrypted payment information using a third key, and sending a payment response including the re-encrypted payment information to a transaction processor. The transaction processor decrypting the re-encrypted payment information using a fourth key and initiating a payment transaction using the decrypted payment information.

Owner:VISA INT SERVICE ASSOC

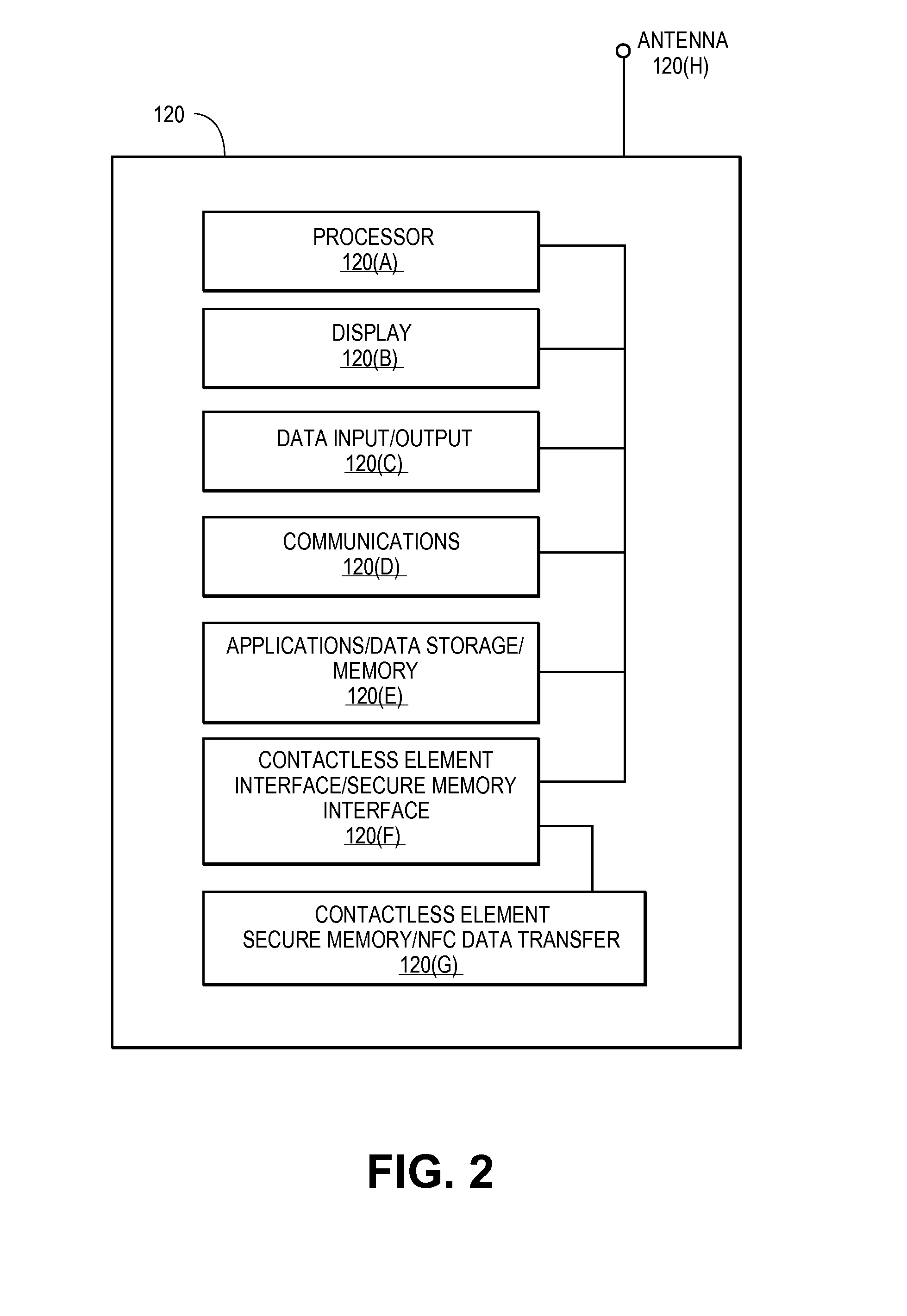

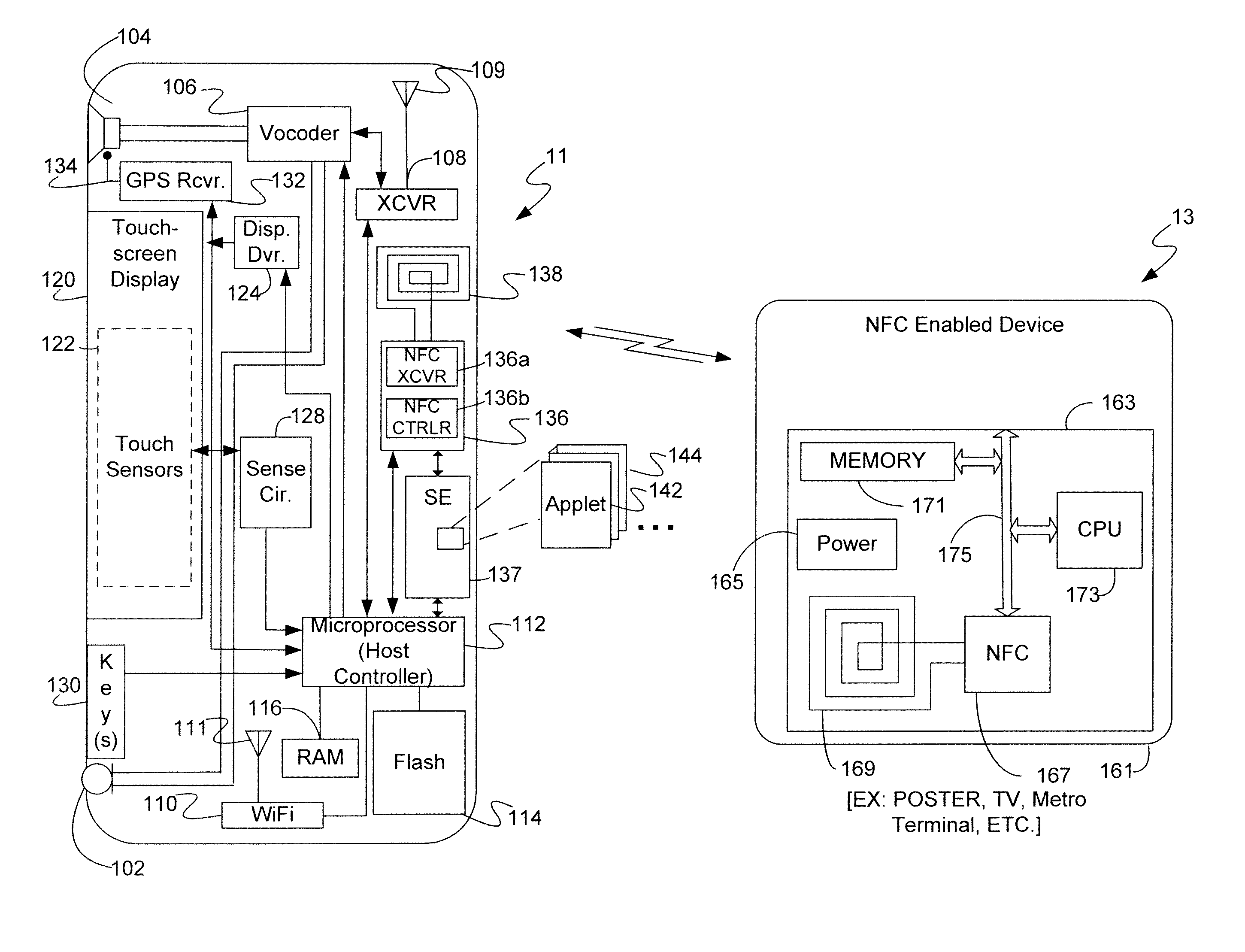

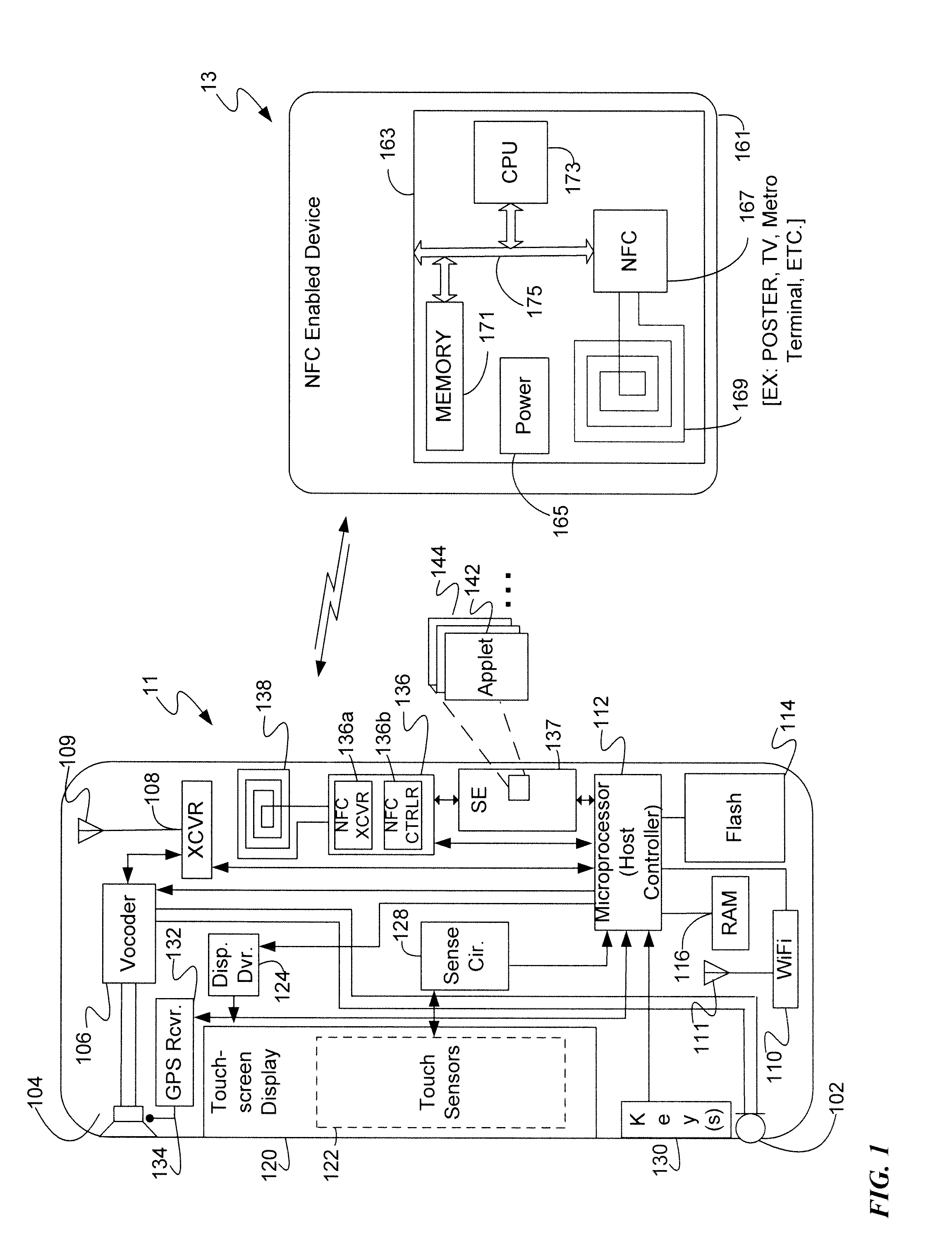

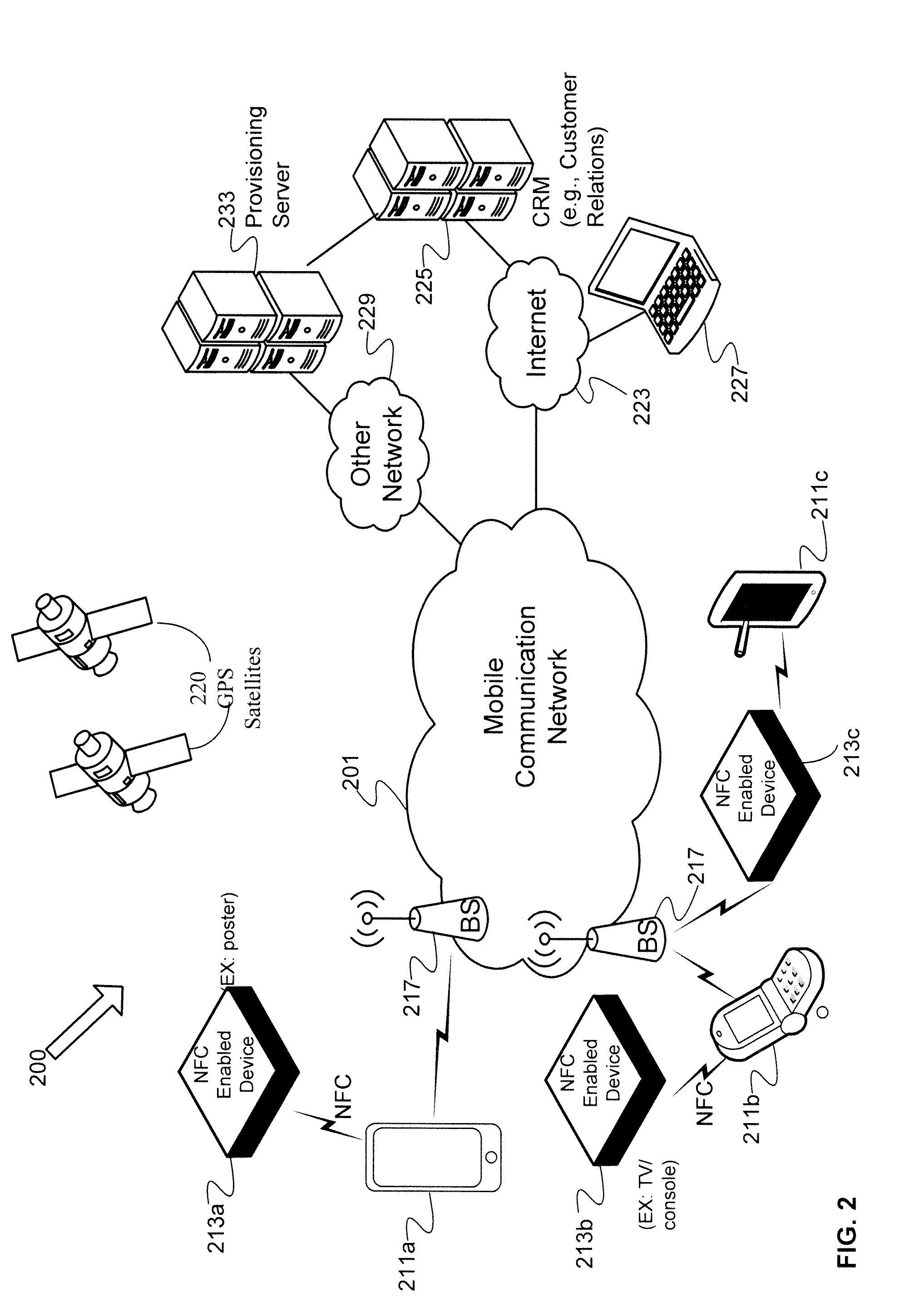

Secure NFC data authentication

ActiveUS20140256251A1Near-field systems using receiversPayment architectureTransceiverWireless transceiver

A mobile device includes a wireless transceiver, a host processor, a secure element (SE), and a near field communication (NFC) system having an NFC transceiver and an NFC controller implementing a contactless front end. The contactless front end routes a near field communication related to a payment transaction between the NFC system and the SE without going to or from the host processor. The contactless front end routes a near field communication not related to a payment transaction, but requiring a security function, between the NFC system and the SE without going to or from the host processor. The contactless front end routes a near field communication not related to a payment transaction, and not requiring a security function, between the NFC system and host processor without going to or from the SE.

Owner:CELLCO PARTNERSHIP INC

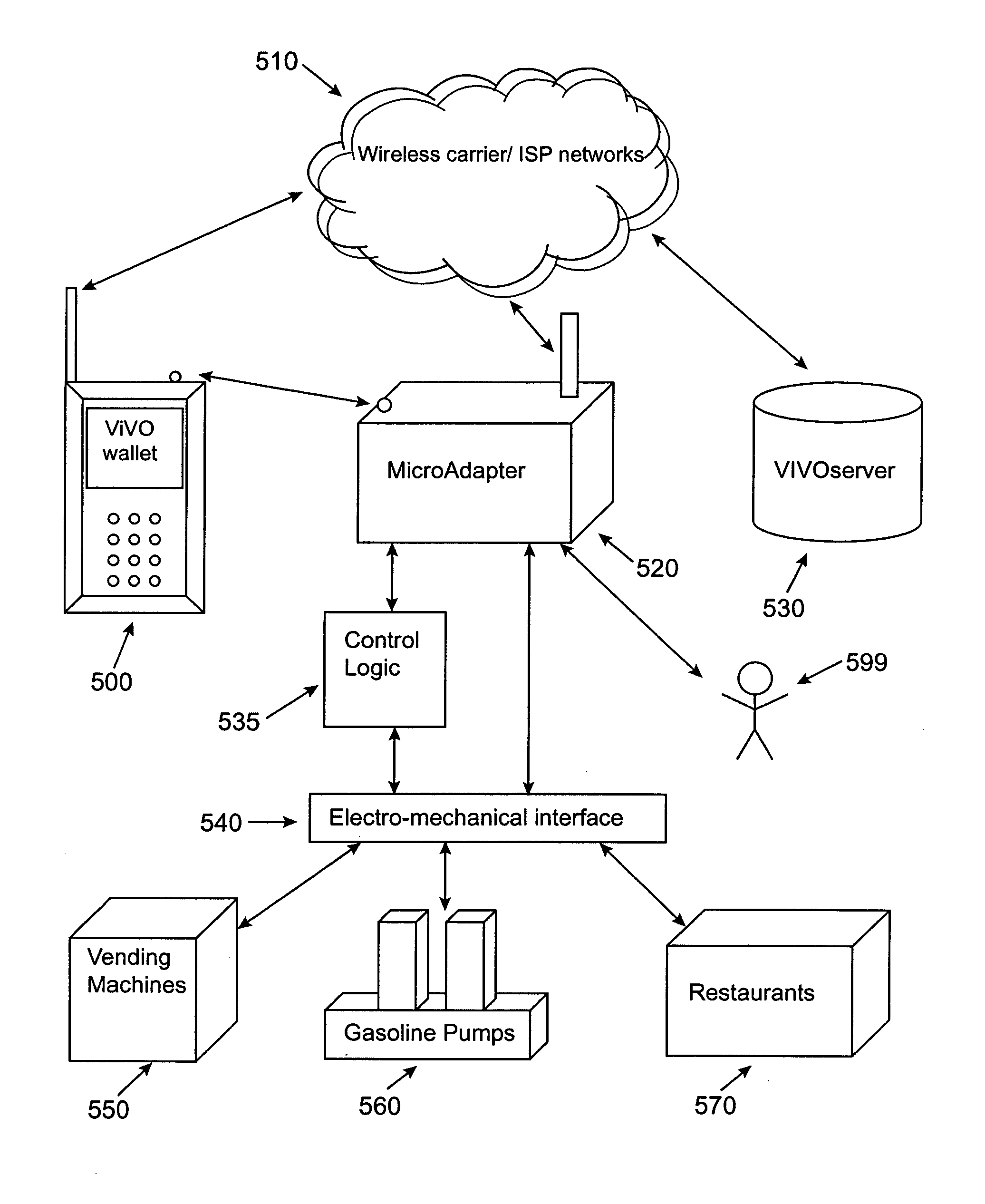

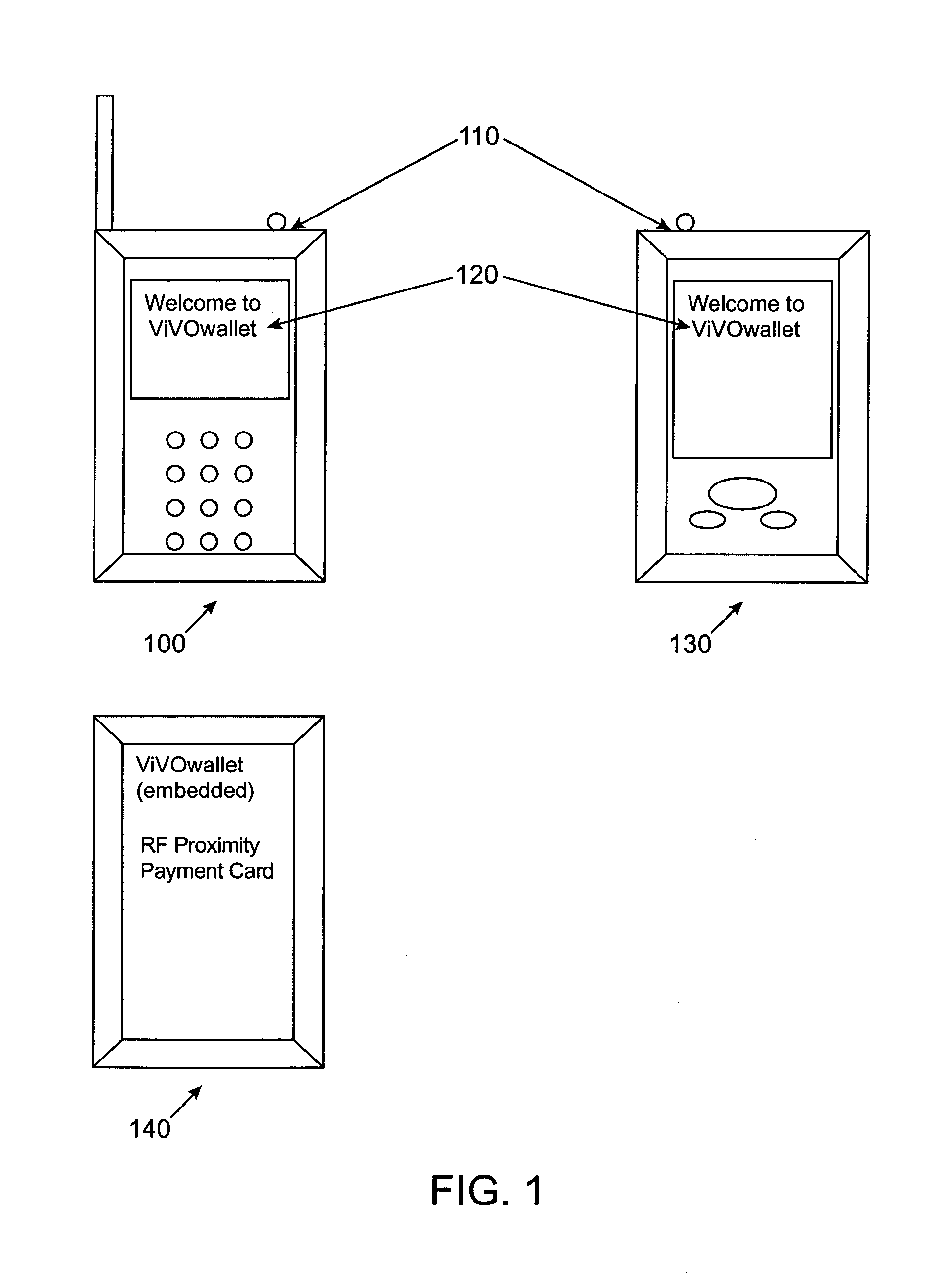

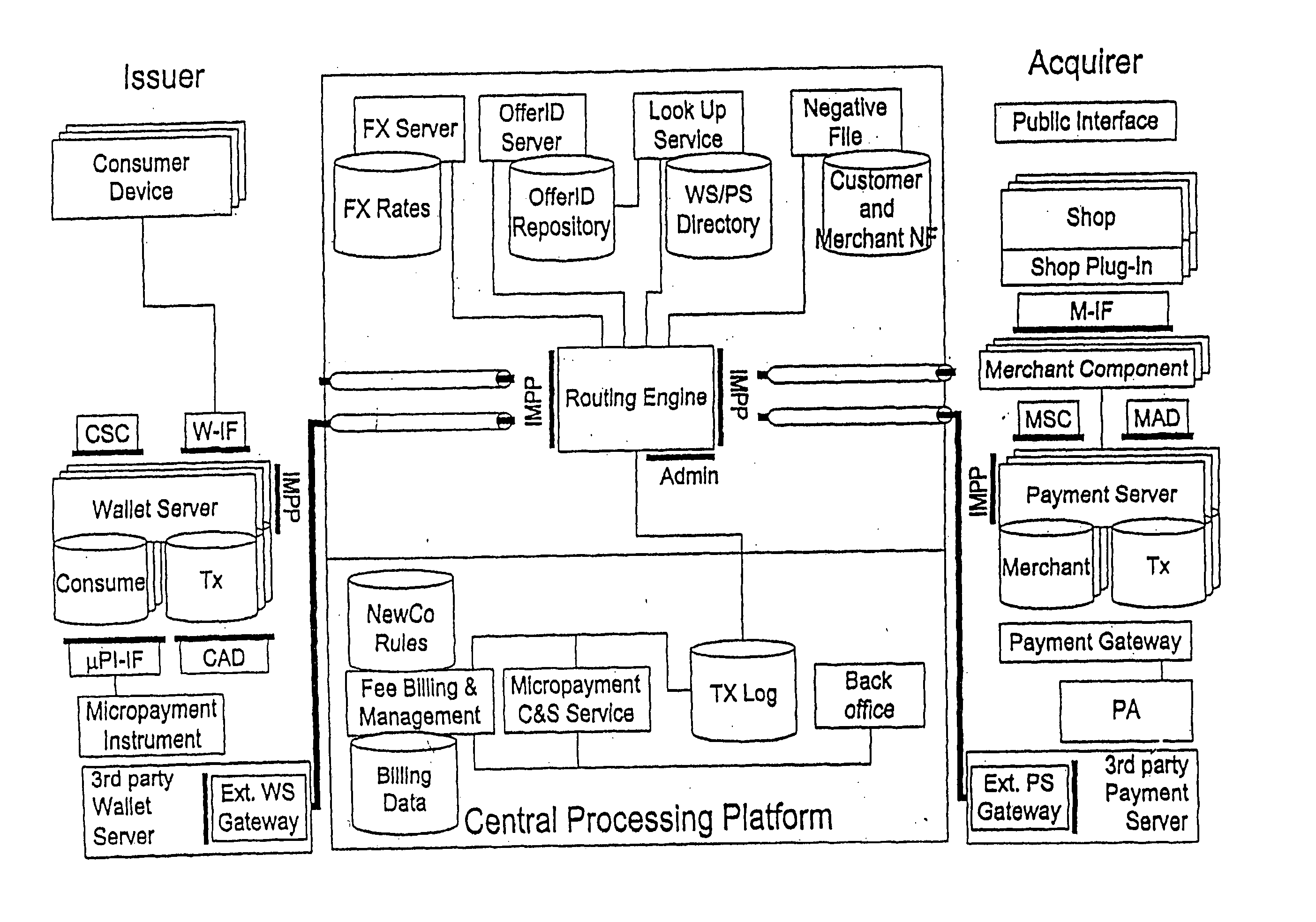

Micropayment financial transaction process utilizing wireless network processing

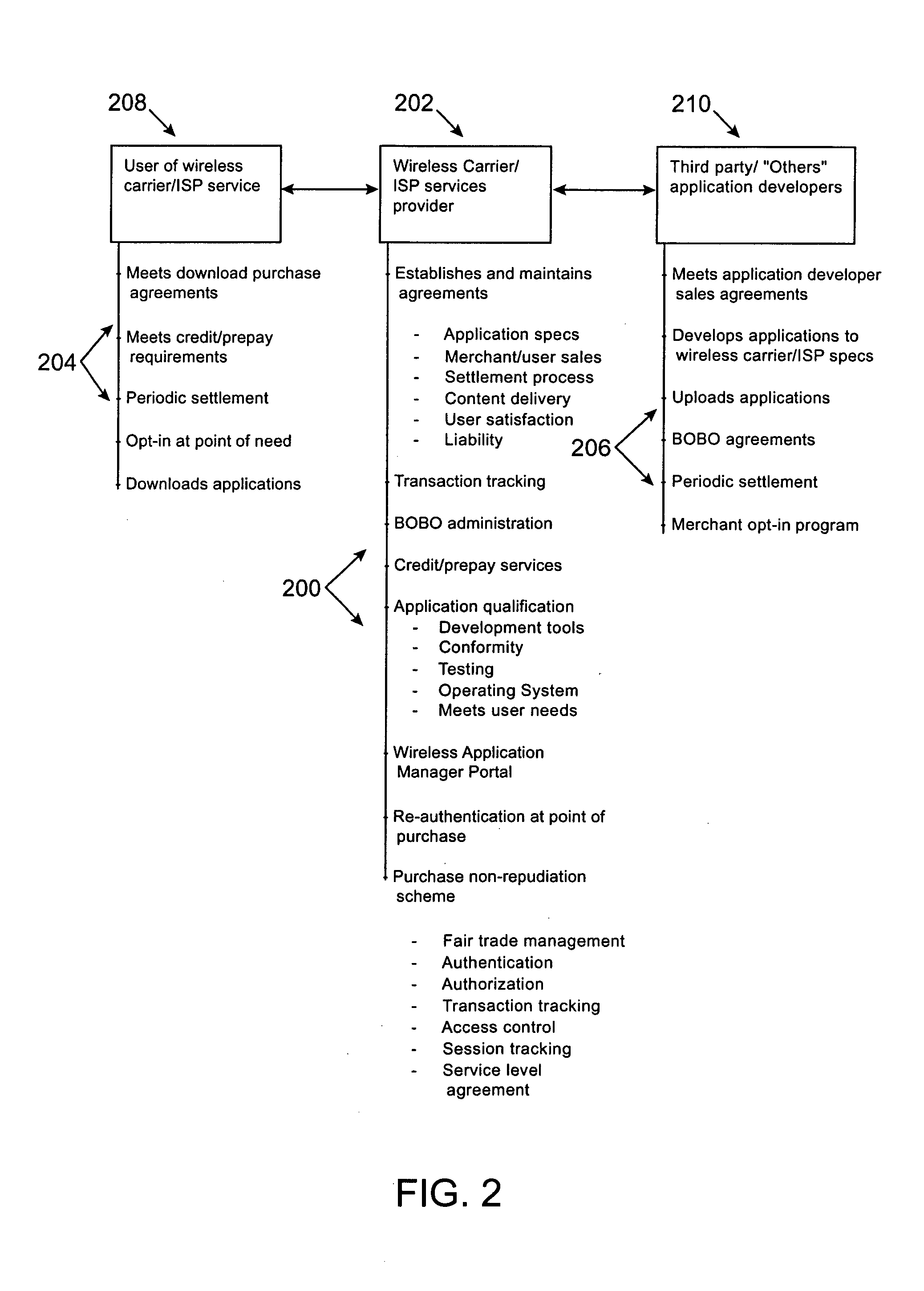

InactiveUS7127236B2Unauthorised/fraudulent call preventionEavesdropping prevention circuitsThird partyTransceiver

A MicroAdapter device enables payment transactions to be effected through a purchaser's personal trusted device (PTD) without relying upon tokens or prepayment cards. In one embodiment, the MicroAdapter includes a transceiver configured to receive a purchase signal from the PTD including order and payment information. In response, the MicroAdapter communicates via wireless telephony with a transaction authorizer to receive authorization for effectuating the purchase transaction. The MicroAdapter may be particularly suited to effectuate micropayment transactions authorized by a Billing On Behalf of Others (BOBO) program administered through a wireless carrier / ISP or third party.

Owner:MASTERCARD INT INC

Network token system

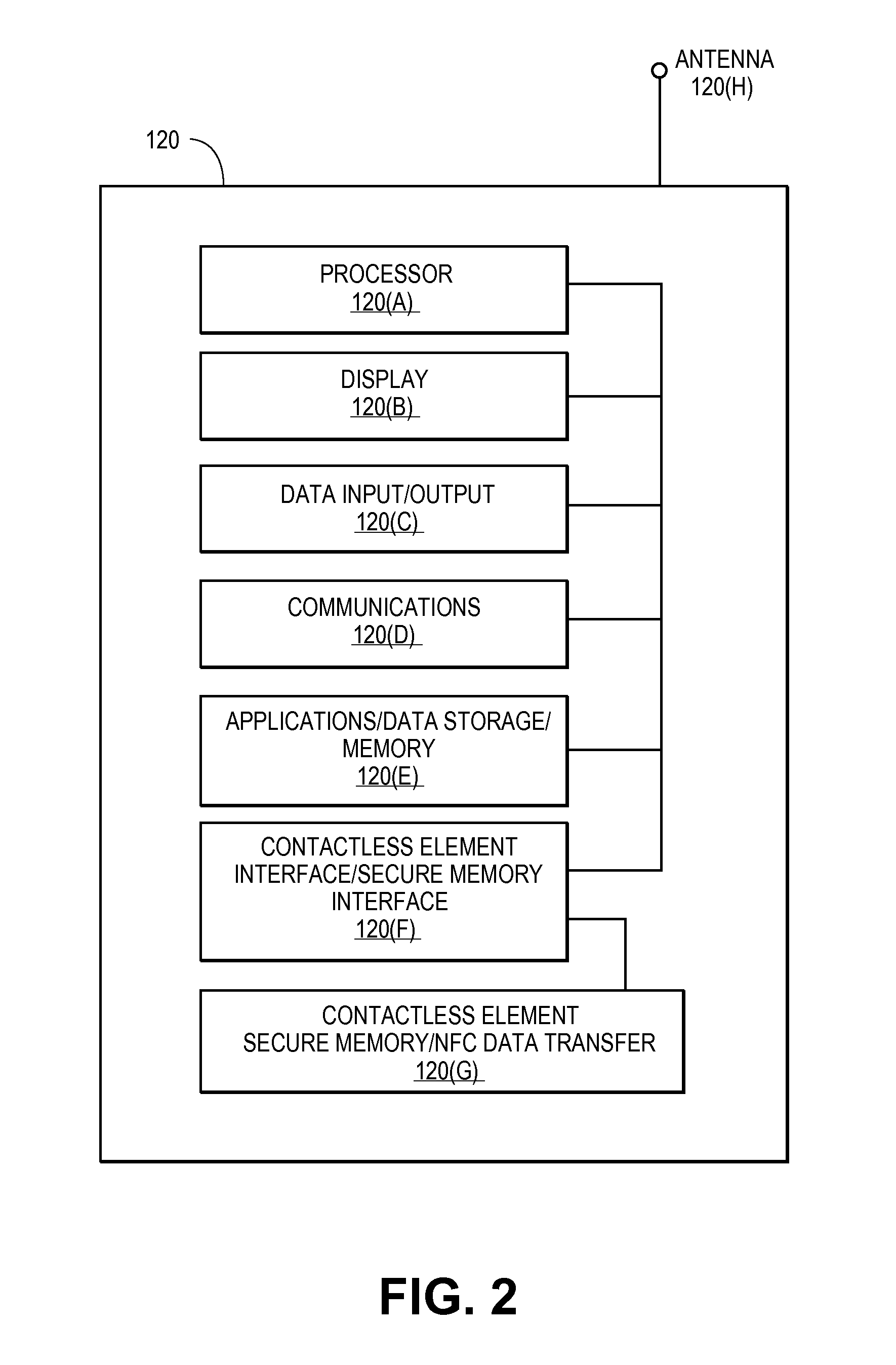

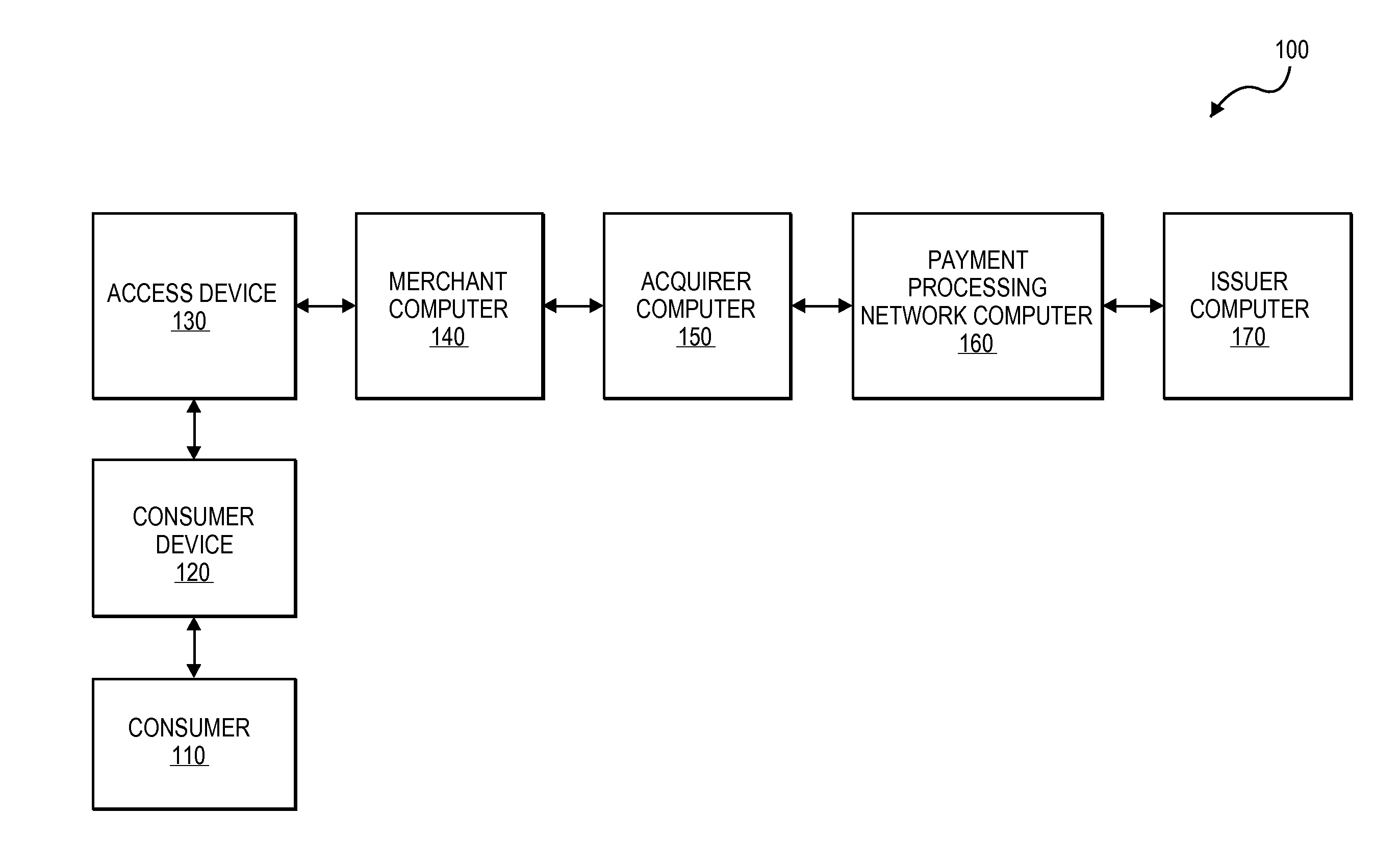

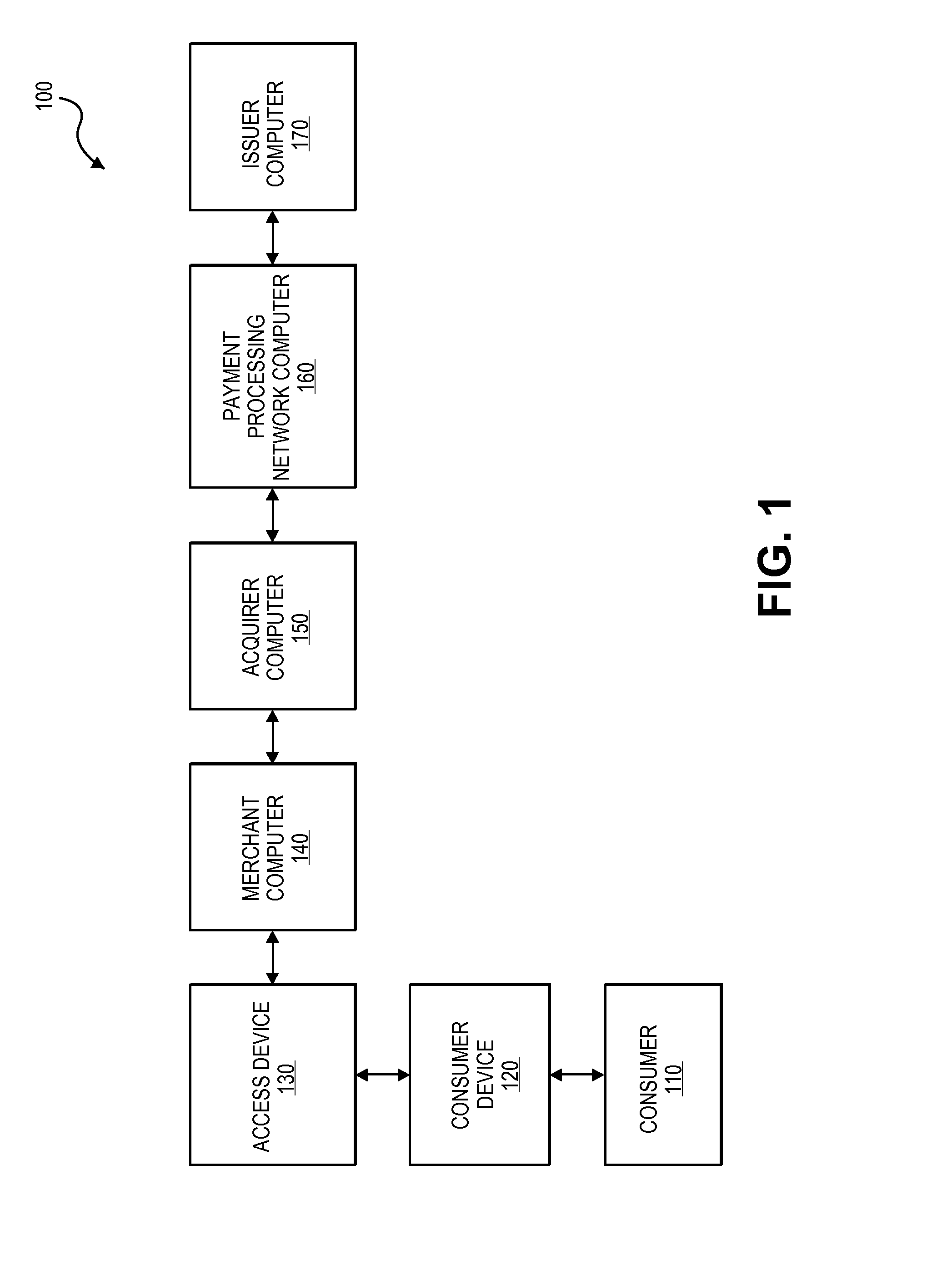

ActiveUS20150127547A1User identity/authority verificationPoint-of-sale network systemsPayment transactionOperating system

Owner:MASTERCARD INT INC +1

Mobile telephone transaction systems and methods

InactiveUS20090281904A1Hand manipulated computer devicesAccounting/billing servicesTransaction servicePayment transaction

Techniques are disclosed for a mobile telephone, in conjunction with a payment transaction server, to be used directly as a payment device for a variety of financial transactions. Further, the transaction systems and methods for mobile telephone devices described herein allow a mobile telephone to participate in payment transactions in a manner that helps prevent identify theft and without relying on transferring amounts to / from one stored value account to another.

Owner:GLOBAL 1 ENTERPRISES

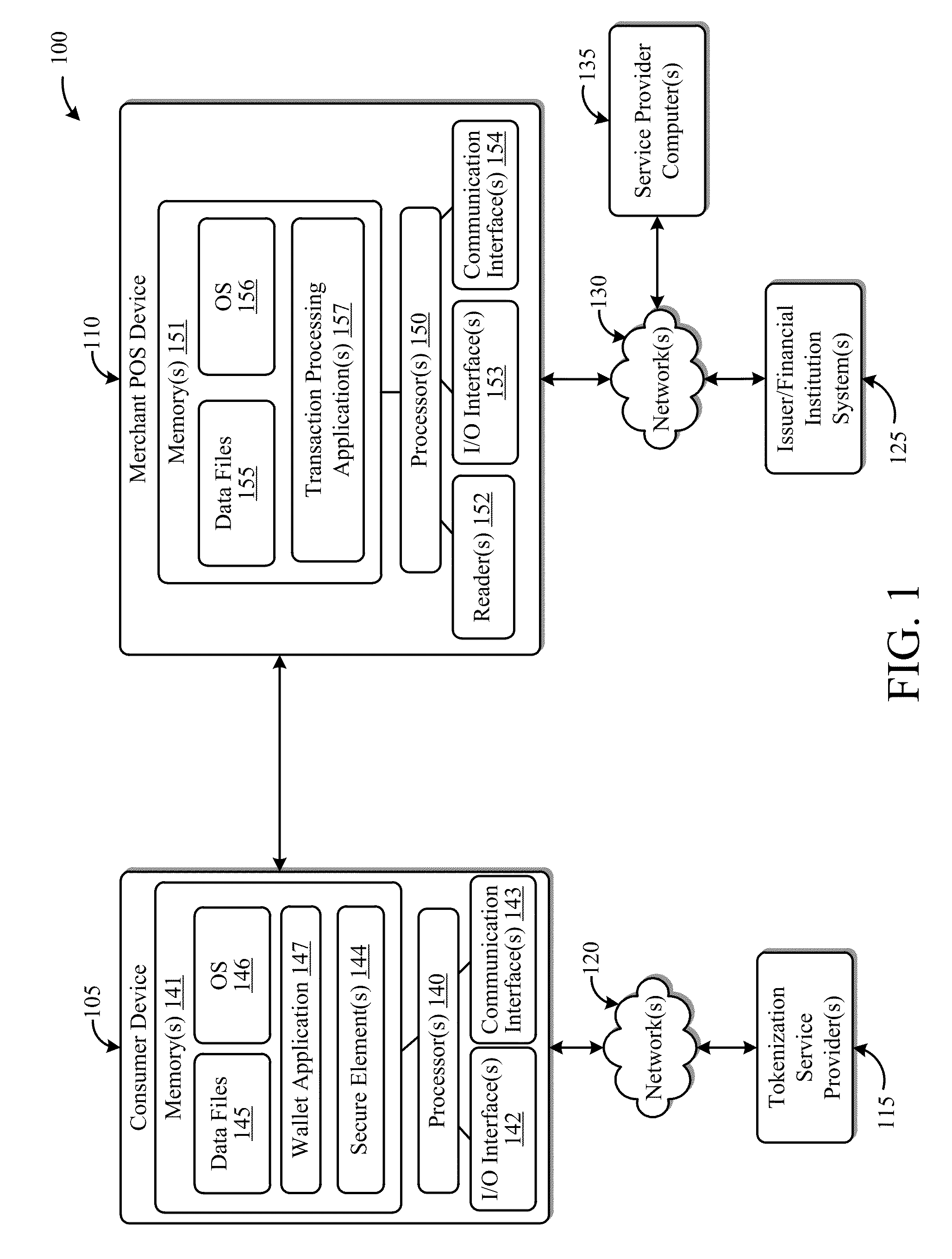

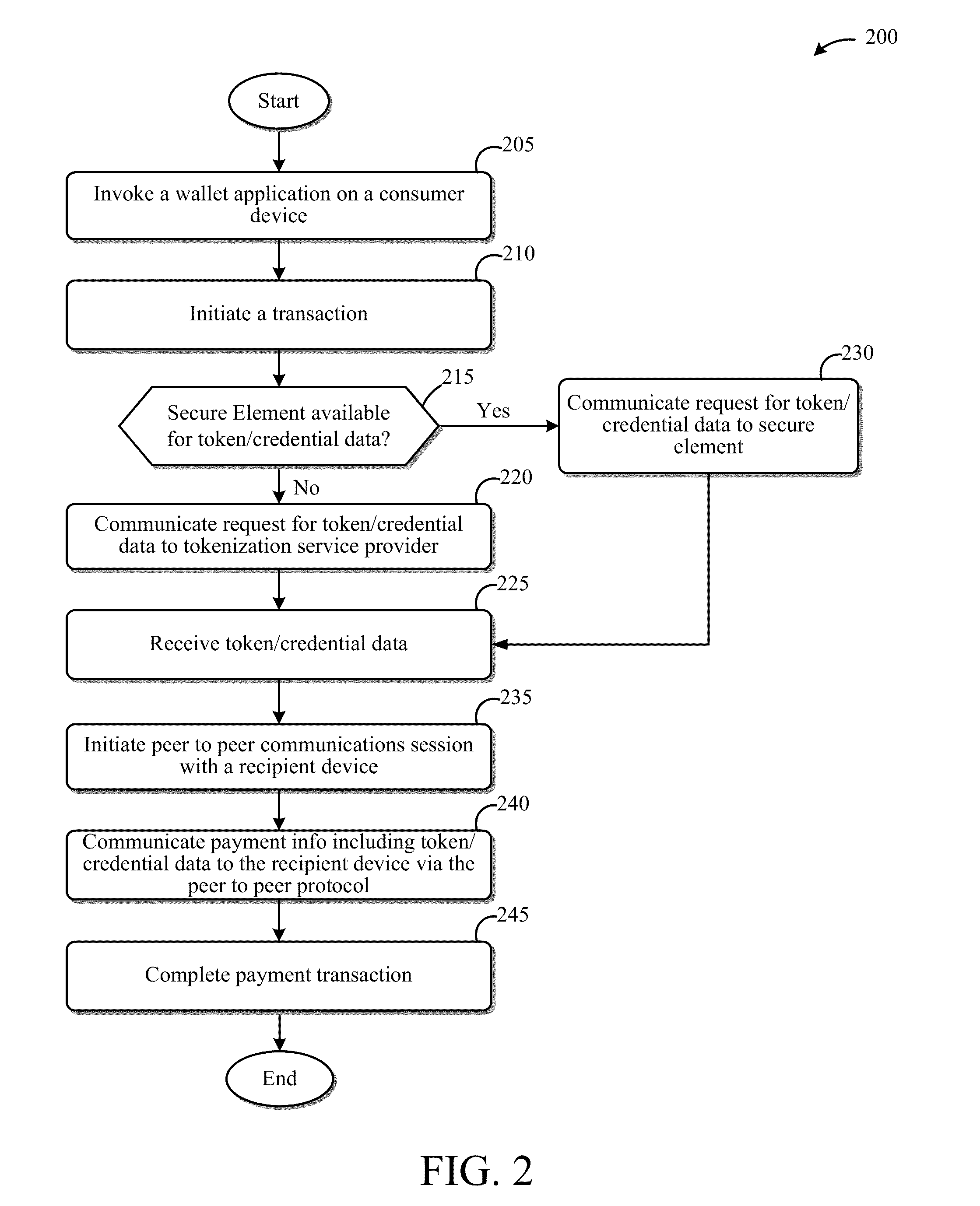

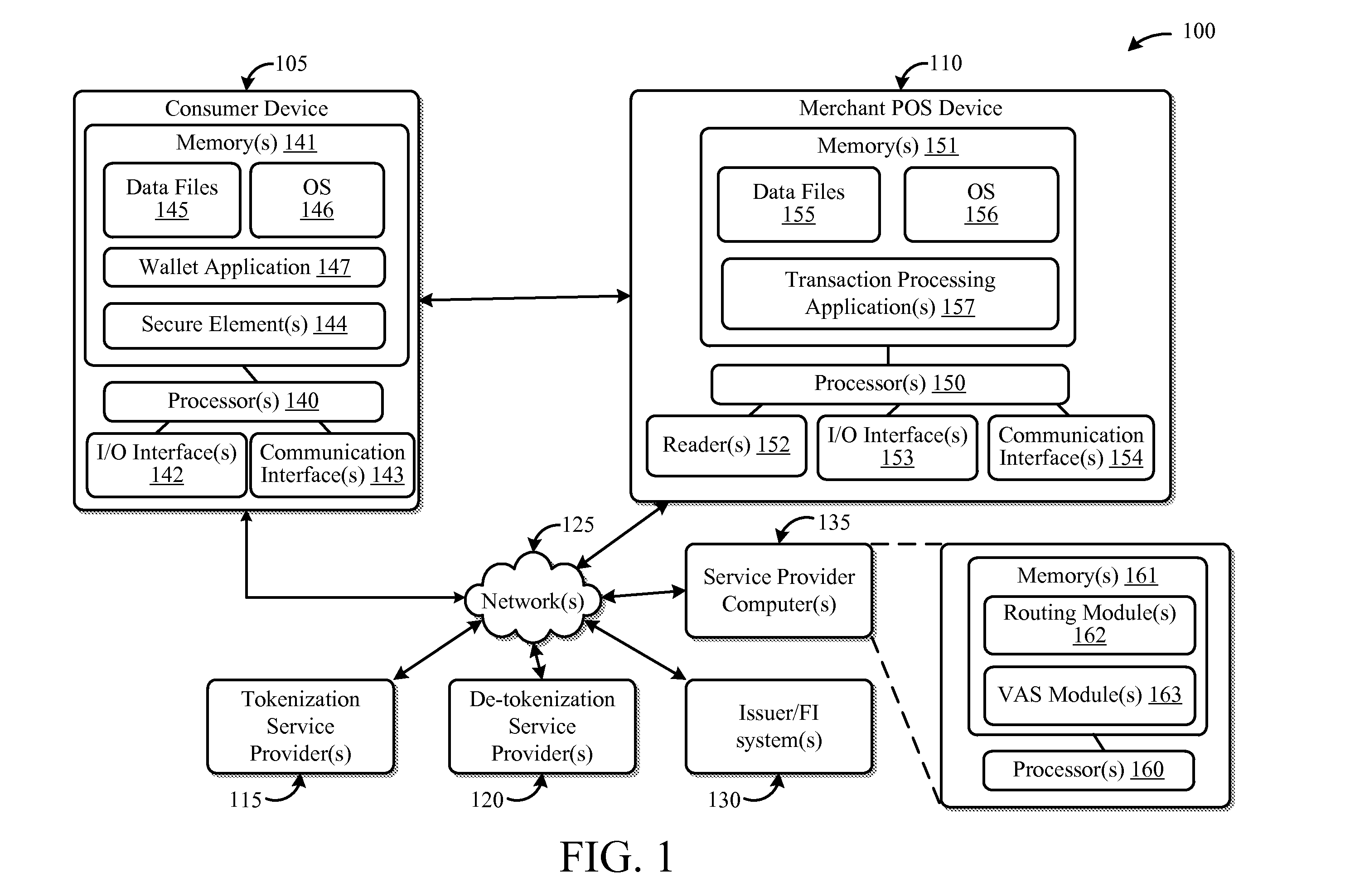

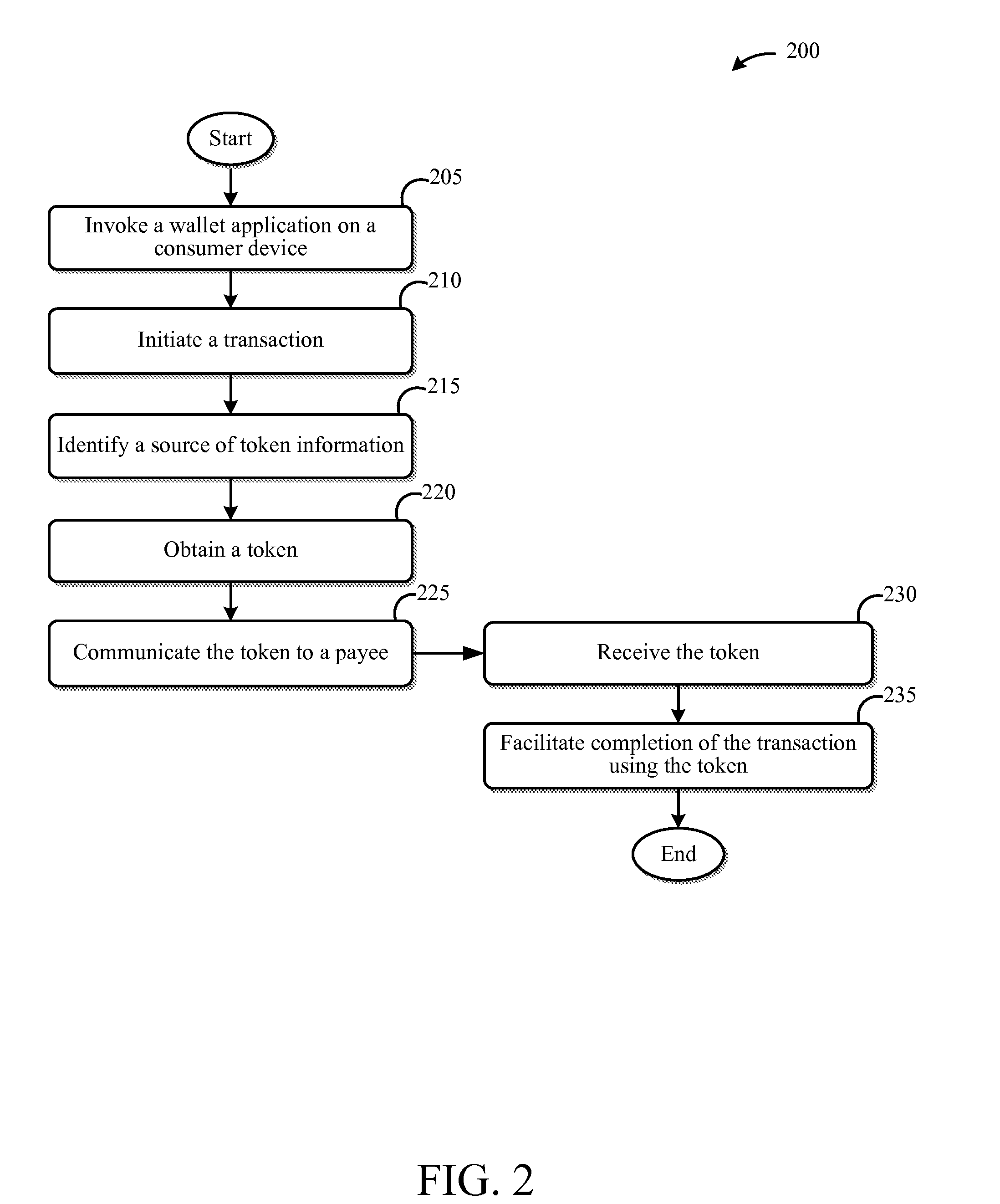

Systems and Methods for Facilitating Payments Via a Peer-to-Peer Protocol

ActiveUS20130254052A1Facilitate peer-to-peer communicationEasy to completeHand manipulated computer devicesFinancePoint-to-Point ProtocolPayment transaction

This disclosure describes systems and methods related to facilitating payments via a peer-to-peer protocol. Tokenized information associated with a payment transaction may be obtained. Establishment of a peer-to-peer communications session with a payment recipient device may be facilitated. The tokenized information to the recipient device via the established peer-to-peer communications session may be communicated in order to facilitate completion of the payment transaction.

Owner:FIRST DATA

Secure Remote Payment Transaction Processing Using a Secure Element

ActiveUS20150052064A1Improve security levelImprove securityPayment protocolsSecuring communicationPayment transactionTransaction data

Embodiments of the present invention are directed to methods, apparatuses, computer readable media and systems for securely processing remote transactions. One embodiment of the invention is directed to a method of processing a remote transaction initiated by a mobile device. The method comprises receiving, by a mobile payment application on a secure memory of the mobile device, transaction data from a transaction processor application on the mobile device. The method further comprises validating that the transaction processor application is authentic and in response to validating the transaction processor application, providing encrypted payment credentials to the transaction processor application. The transaction processor application further initiates a payment transaction with a transaction processor server computer using the encrypted payment credentials.

Owner:VISA INT SERVICE ASSOC

Systems and methods for interoperable network token processing

InactiveUS20150032626A1Easy to optimizeSupported interoperabilityFinanceUser identity/authority verificationPayment transactionPayment service provider

Systems and methods for interoperable network token processing are provided. A network token system provides a platform that can be leveraged by external entities (e.g., third party wallets, e-commerce merchants, payment enablers / payment service providers, etc.) or internal payment processing network systems that have the need to use the tokens to facilitate payment transactions. A token registry vault can provide interfaces for various token requestors (e.g., mobile device, issuers, merchants, mobile wallet providers, etc.), merchants, acquirers, issuers, and payment processing network systems to request generation, use and management of tokens. The network token system further provides services such as card registration, token generation, token issuance, token authentication and activation, token exchange, and token life-cycle management.

Owner:VISA INT SERVICE ASSOC

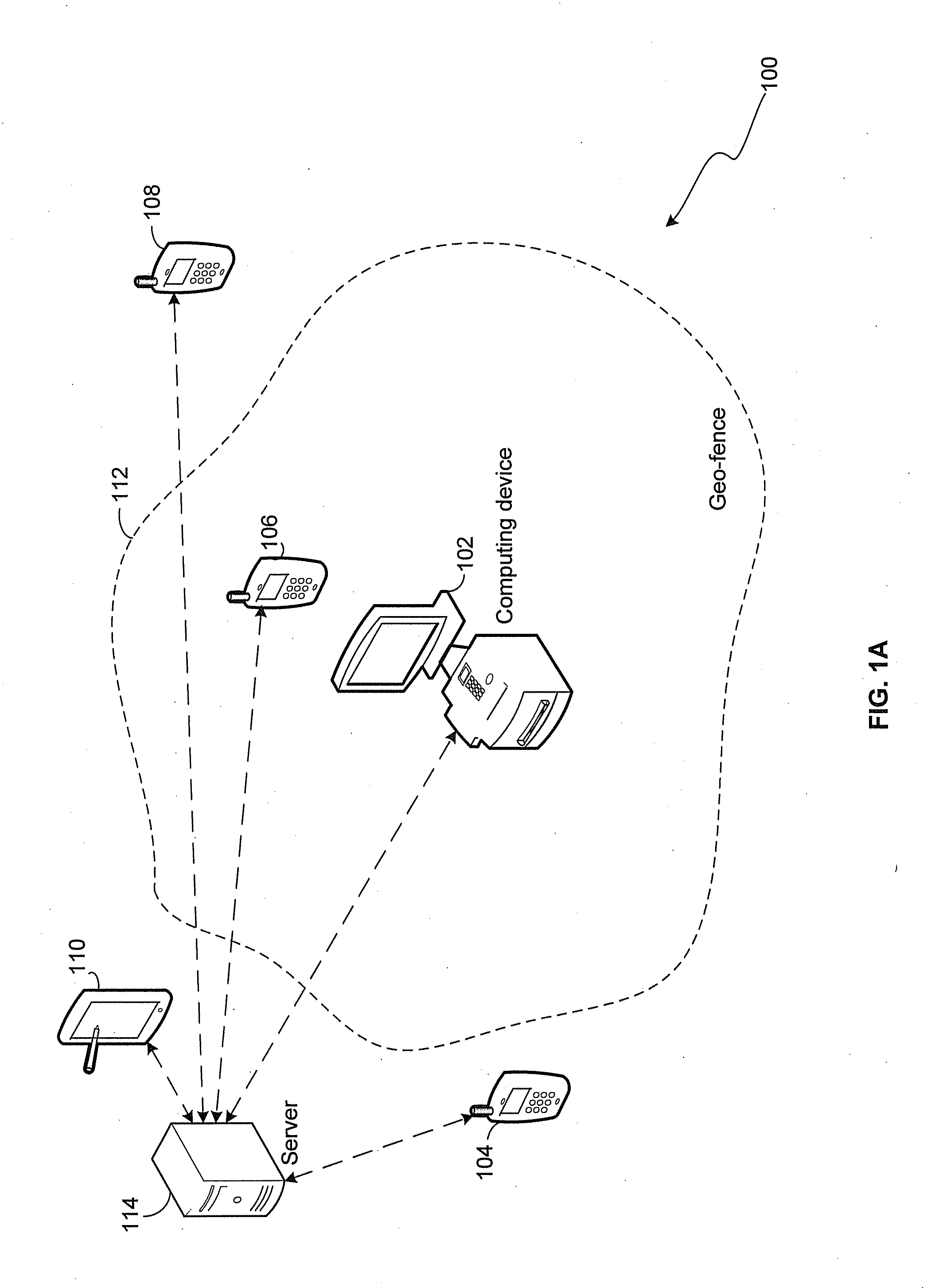

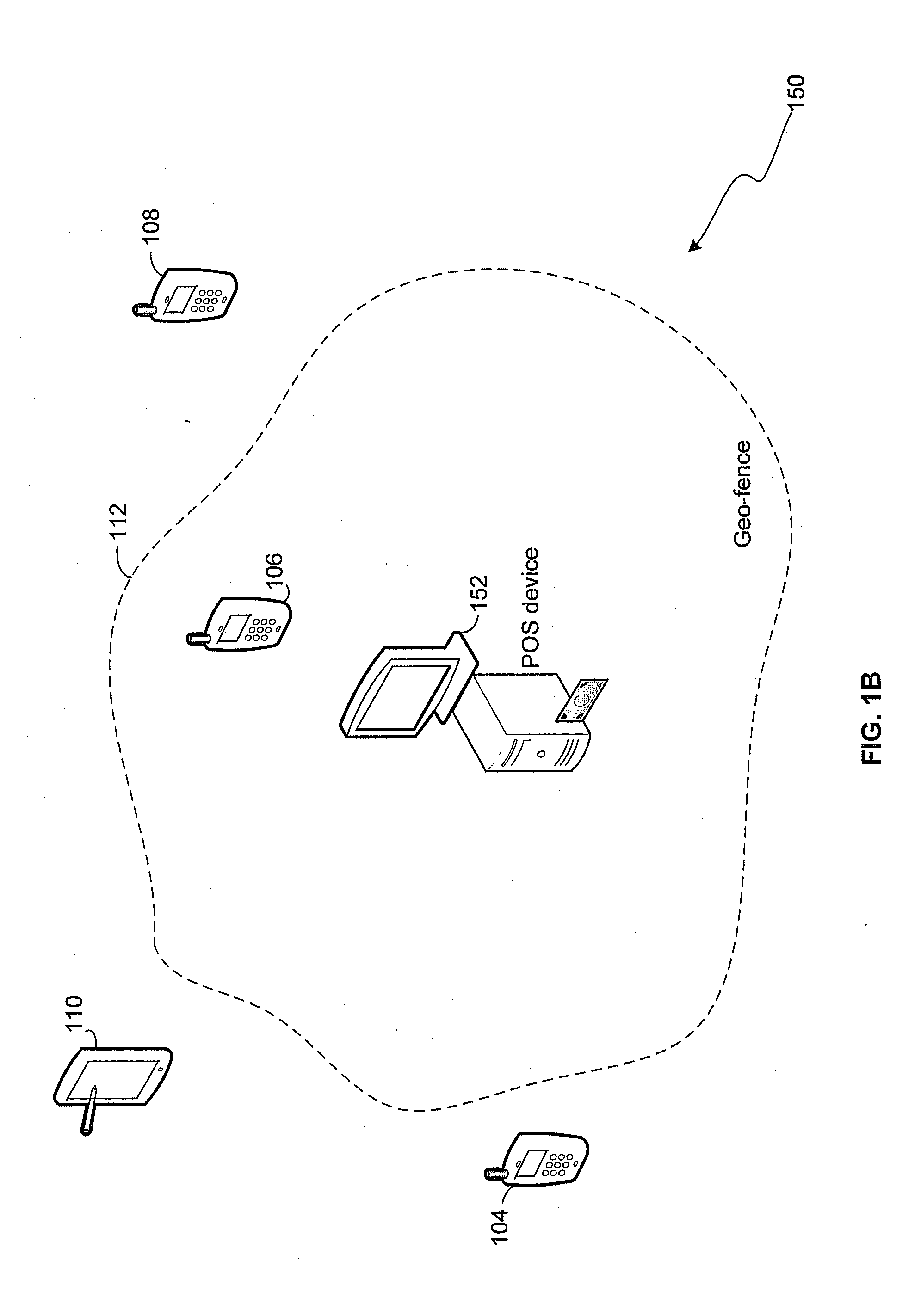

Method and System for Location Based Hands-Free Payment

Certain aspects of a method and system for location based hands-free payment may include a network that comprises a plurality of mobile devices and a plurality of point of sale devices. A first mobile device may determine its location coordinates and communicate them to a selected point of sale device. An authorization to execute a payment transaction may be triggered on the first mobile device when it is within a defined proximity of the selected point of sale device. In another embodiment of the invention, a first point of sale device may determine the location coordinates of a selected mobile device and trigger a notification based on a generated geo-fence when the selected mobile device is within a defined proximity of the first point of sale device.

Owner:GOLBA LLC

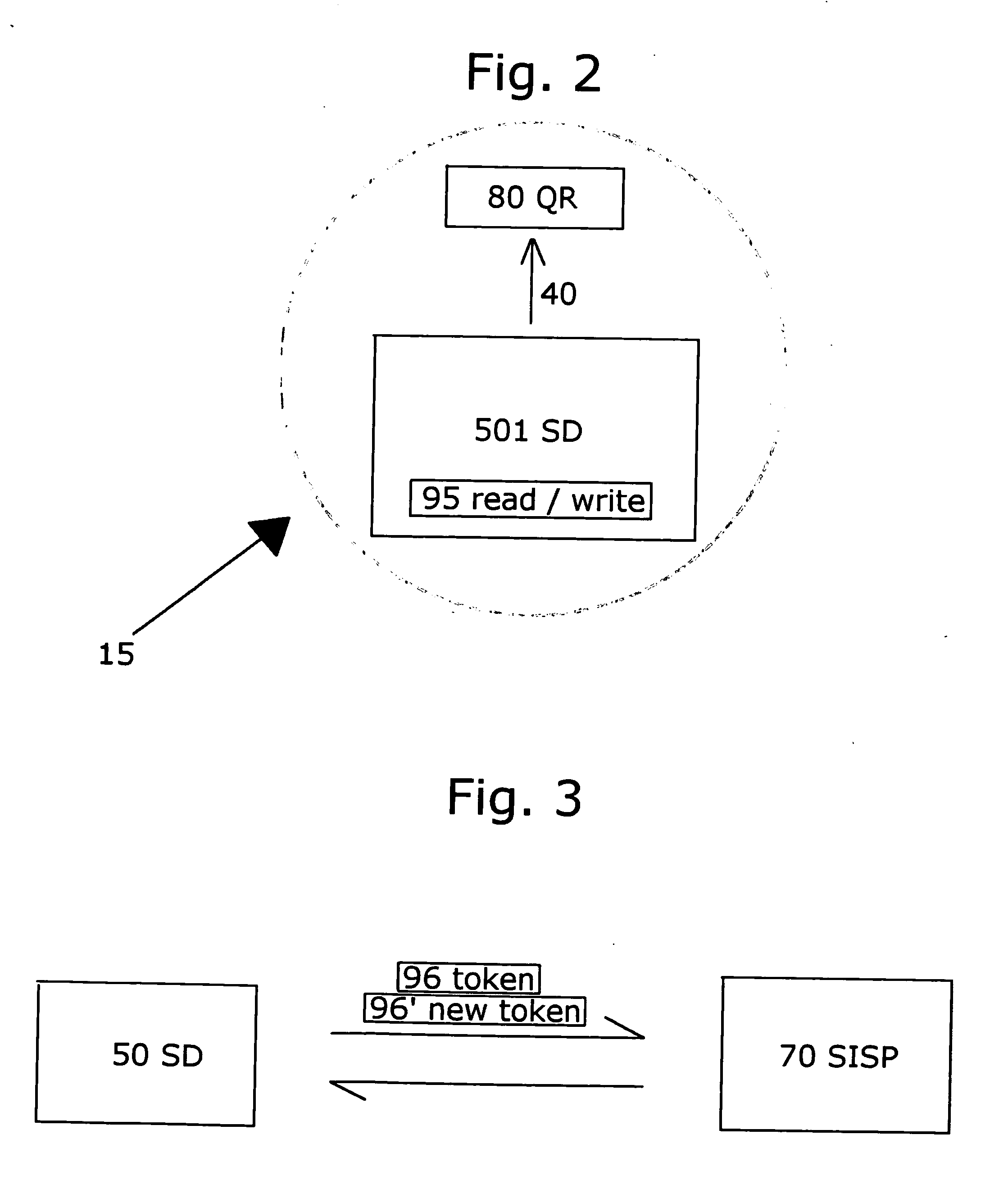

Payment protocol and data transmission method and data transmission device for conducting payment transactions

InactiveUS20050256802A1Avoid misleadingComplete banking machinesFinancePayment transactionData transmission

Owner:AMMERMANN DIRK +13

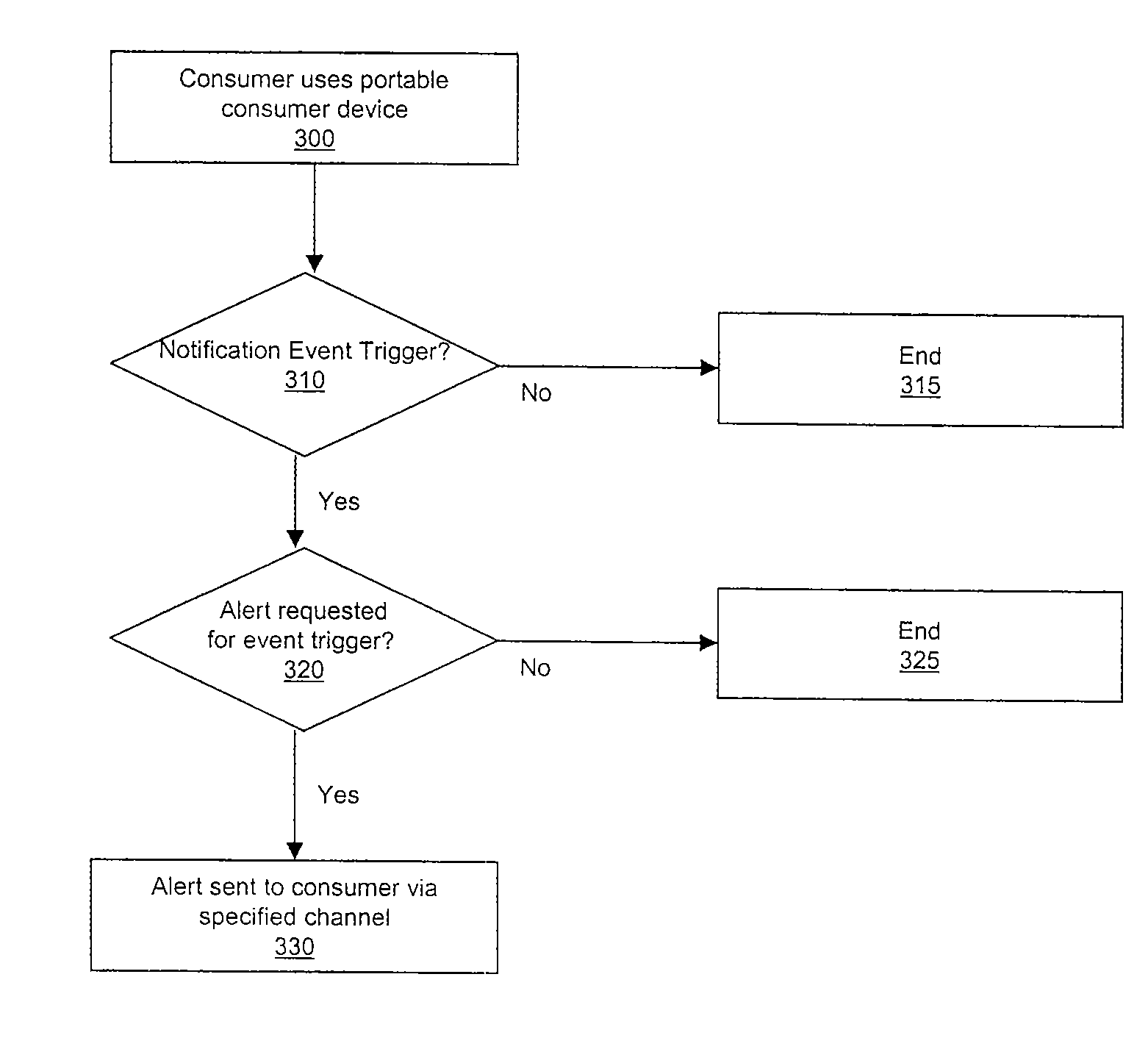

Customized payment transaction notification

InactiveUS20080183480A1Rapid responseAccounting/billing servicesSubstation equipmentPayment transactionReal-time computing

Owner:VISA USA INC (US)

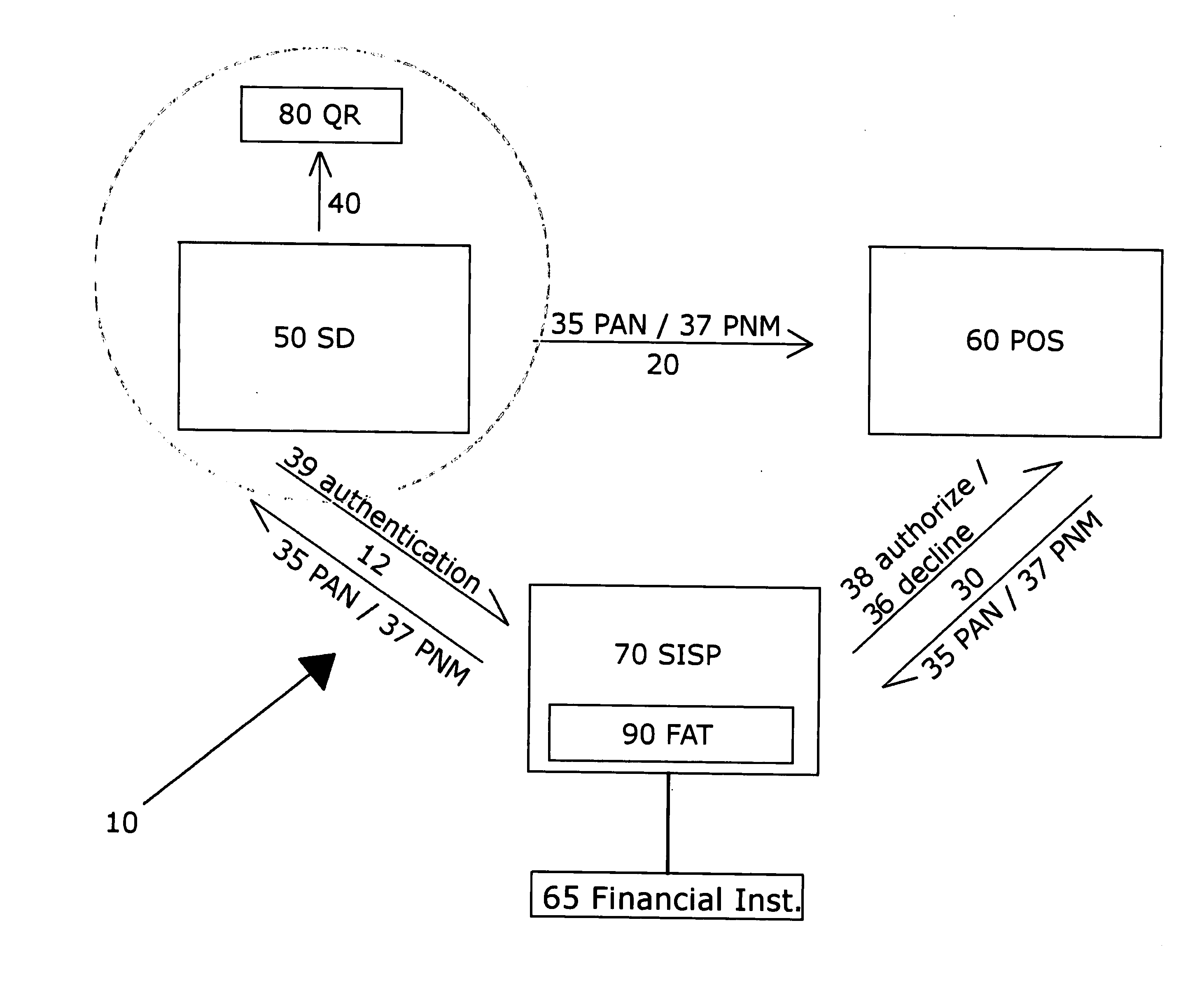

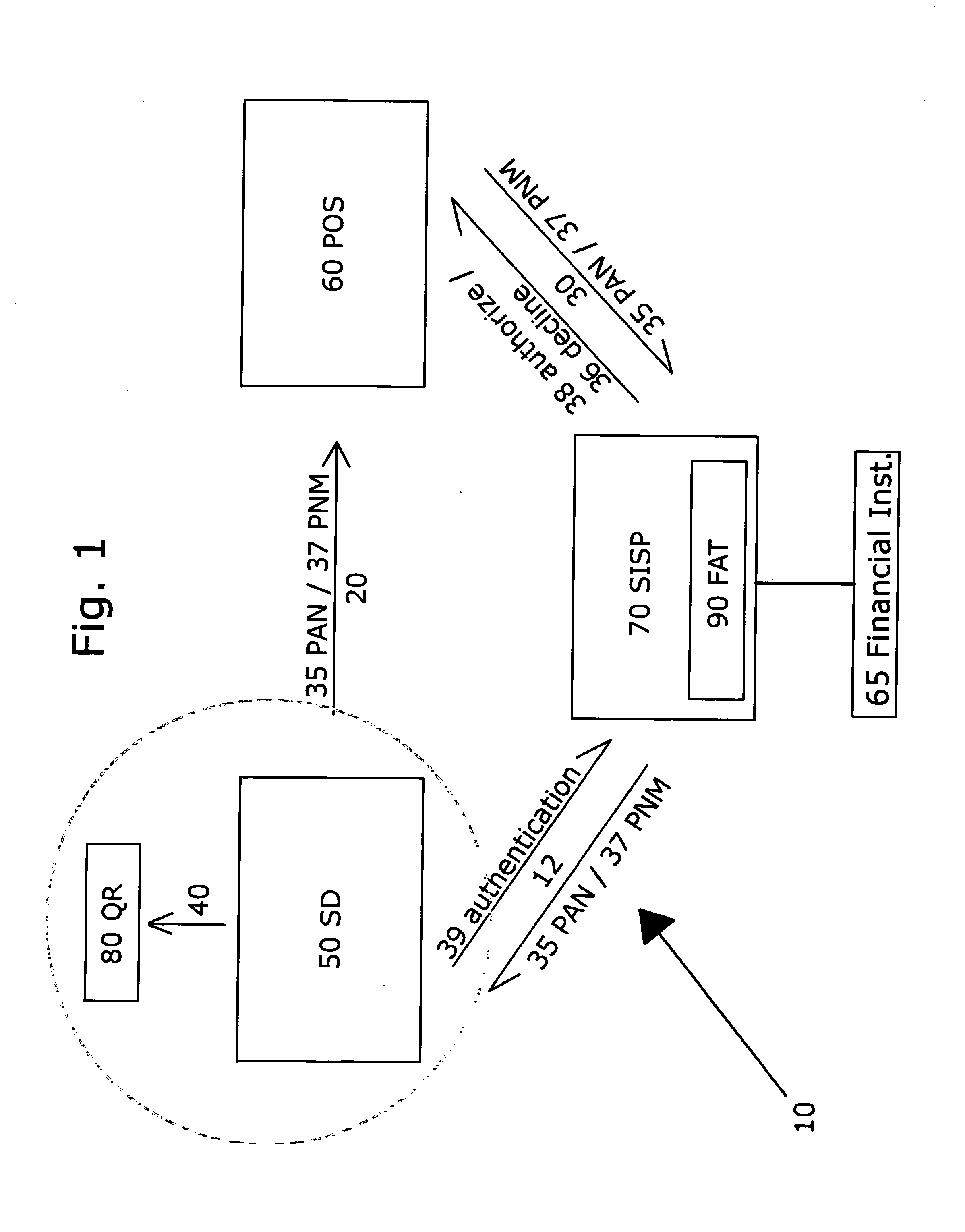

Mobile system and method for payments and non-financial transactions

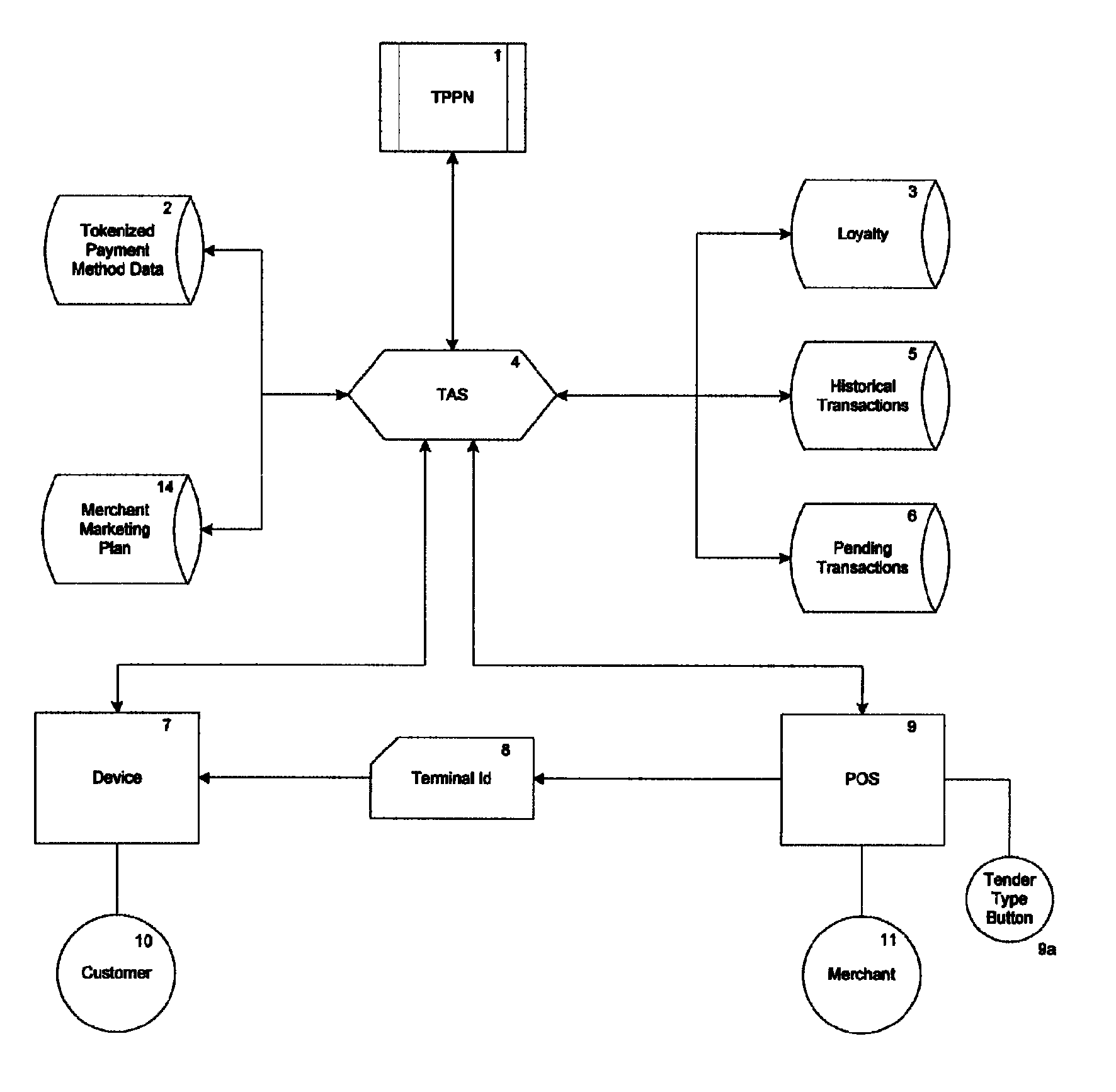

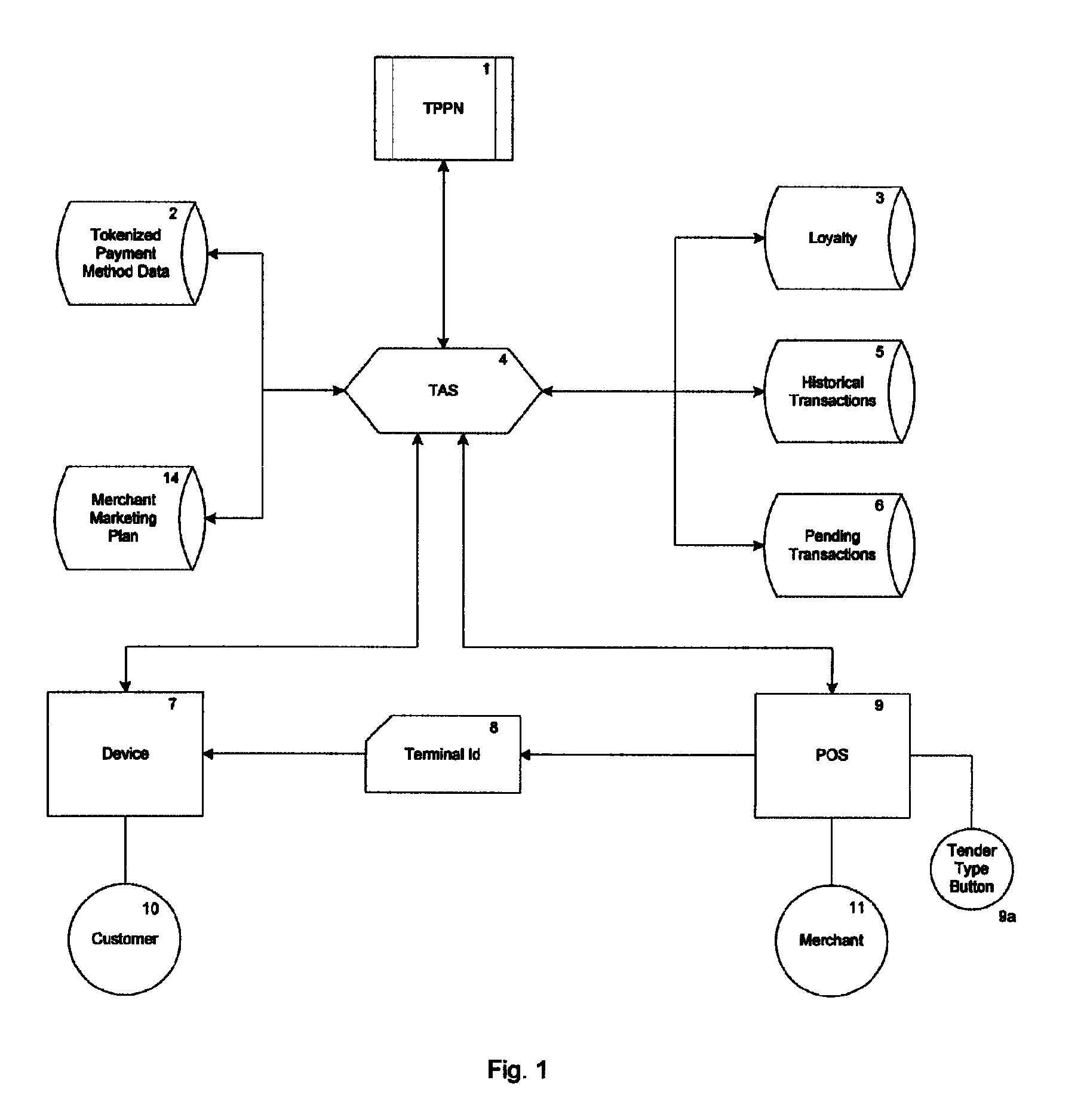

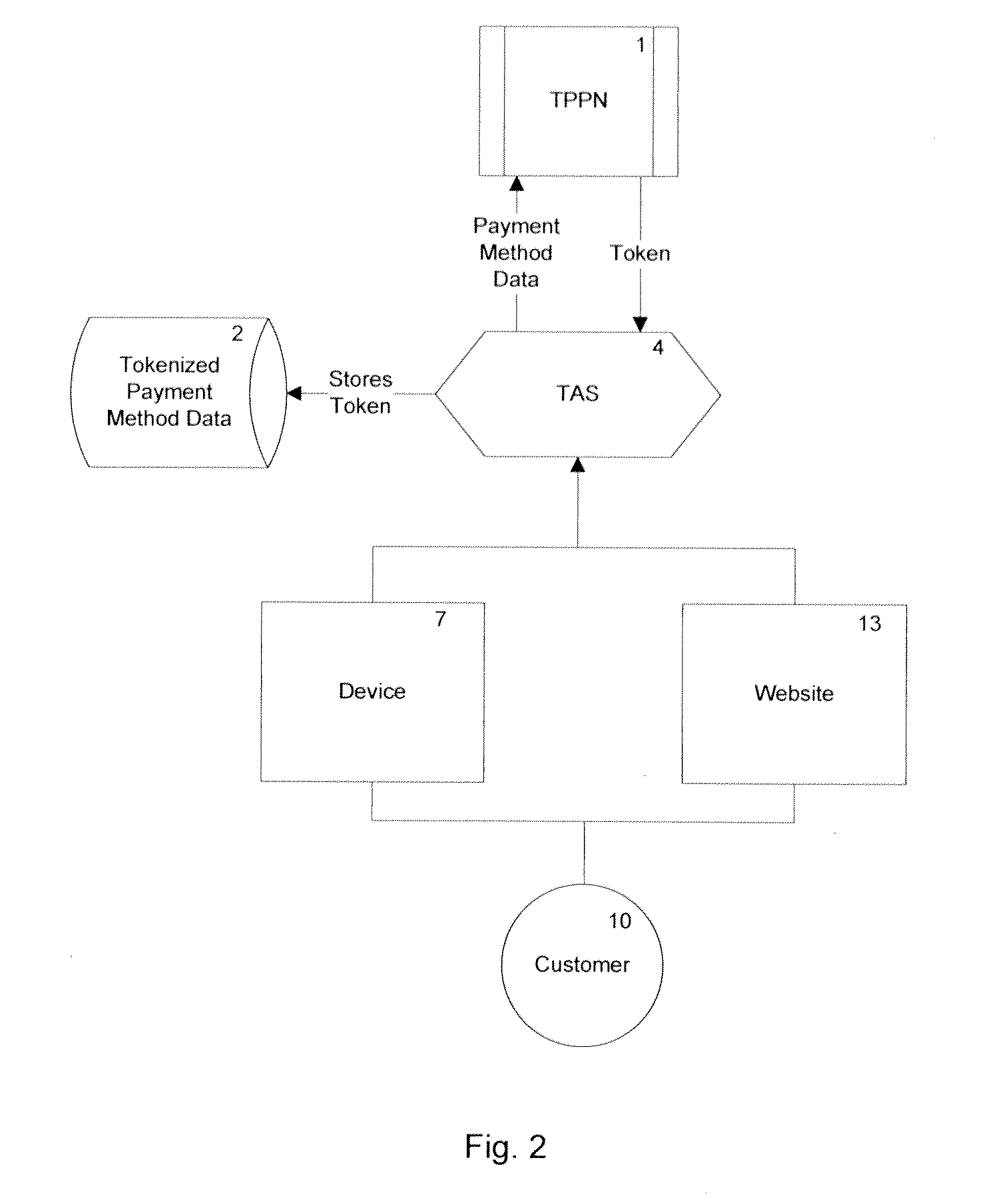

InactiveUS8635157B2Readily availableLow costFinanceBuying/selling/leasing transactionsVirtual terminalPayment transaction

A method and system for mobile commerce, communication, and transaction processing to real-world POS, web, e-commerce, virtual terminal, mobile personal digital assistant, mobile phone, mobile device, or other computer based transactions involving either one or both financial and non-financial such as loyalty based transactions as a mobile payment system is described. One embodiment comprises using a mobile phone via a consumer mobile software application (CMA) in lieu of a consumer card (examples include physical, virtual, or chips) to conduct payment transactions in the Real or Virtual World of commerce. An embodiment is related to making payments to real-world stores via having the CMA on a mobile device on behalf of the consumer present to conduct transactions and no physical card required.

Owner:PAYME

Systems and Methods for Distributing Tokenization and De-Tokenization Services

InactiveUS20130254102A1Easy to identifyFinanceElectronic credentialsPayment transactionComputer science

This disclosure describes systems and methods related to distributing tokenization and de-tokenization services. Information associated with a proposed payment transaction may be received by a payment transaction service provider system. The information may comprise a token generated by a tokenization service provider. A de-tokenization service provider separate from the tokenization service provider may be identified based at least in part upon the received information. The token may be routed by a payment transaction service provider system to the de-tokenization service provider for processing.

Owner:FIRST DATA

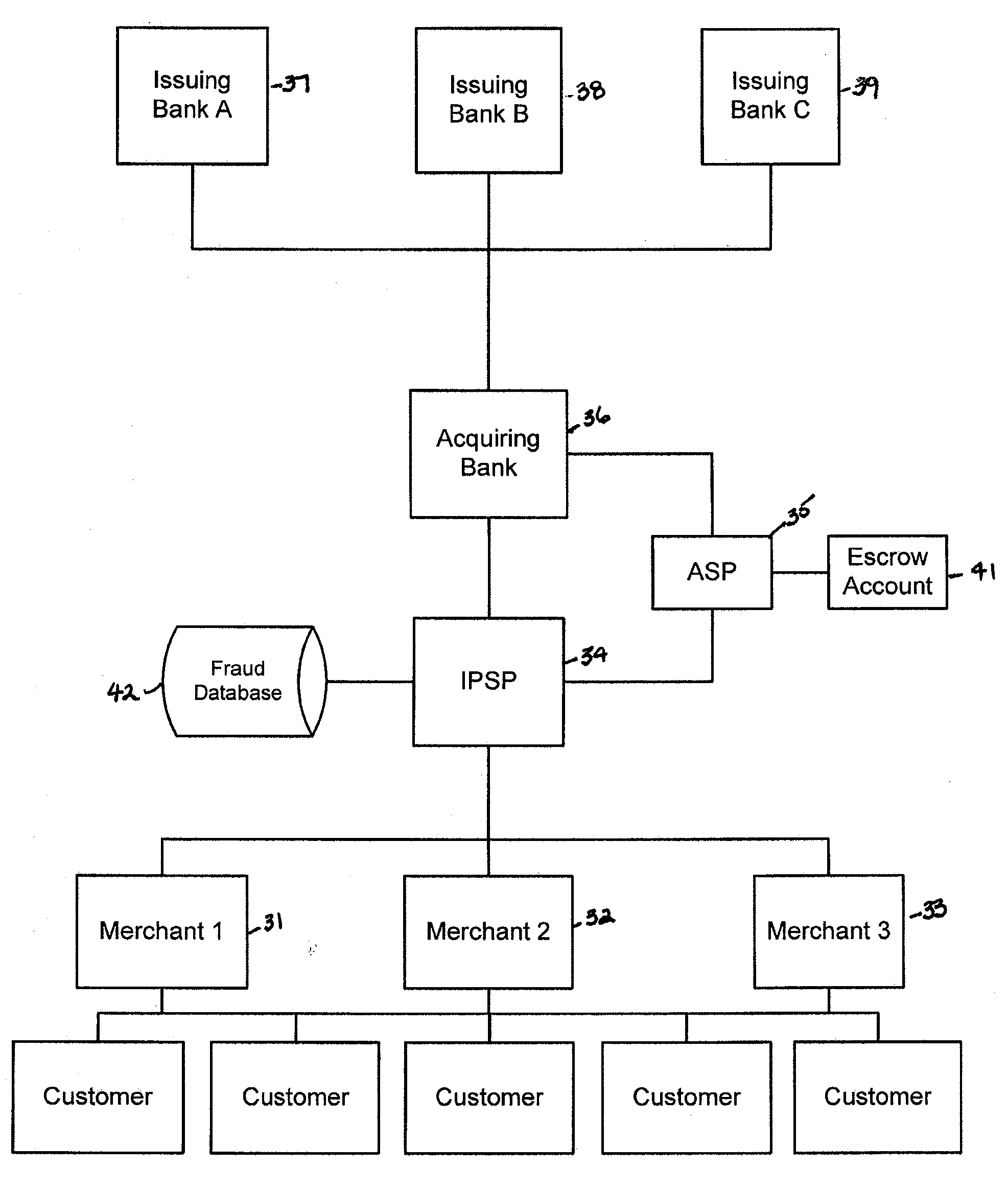

Financial transactions systems and methods

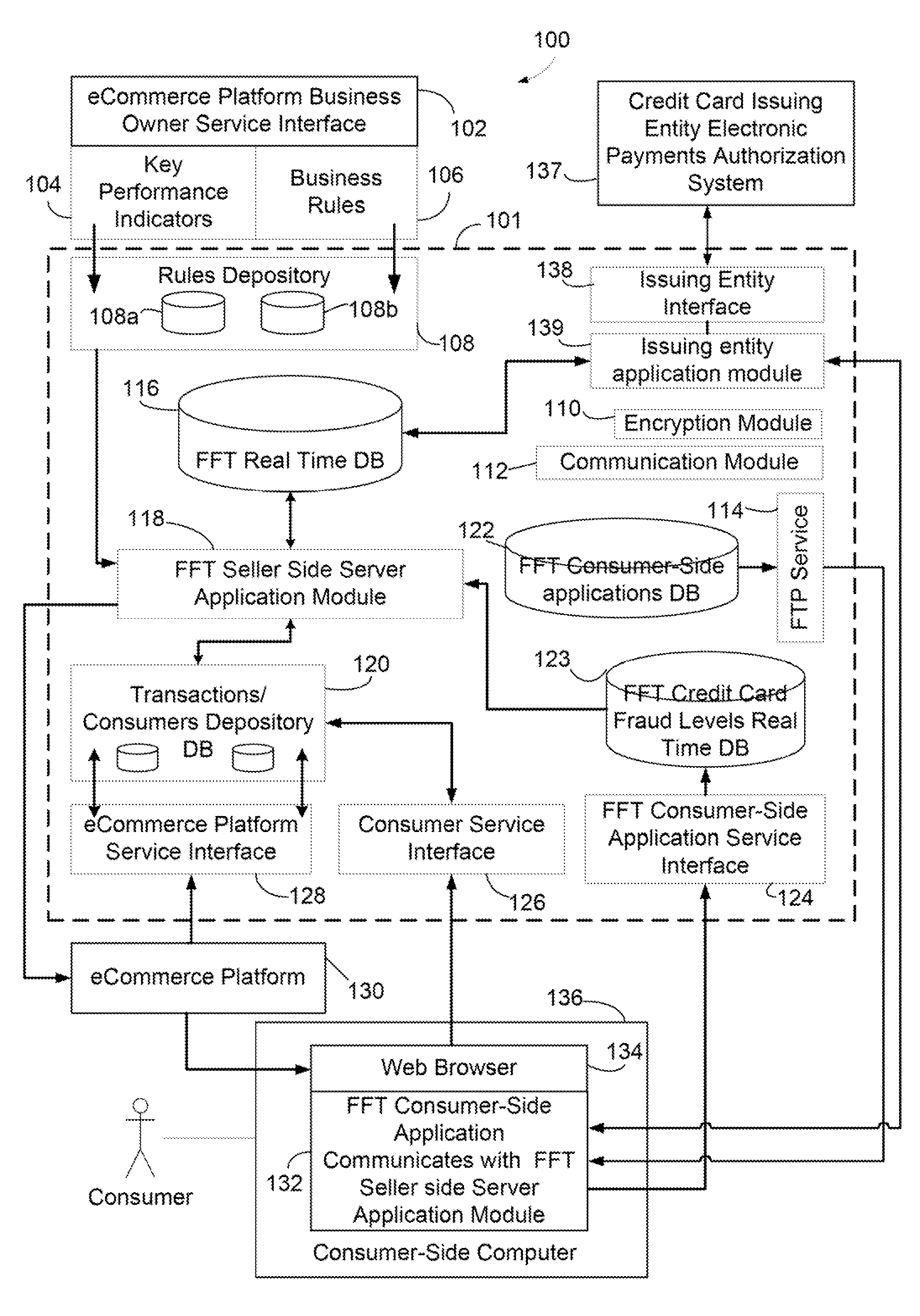

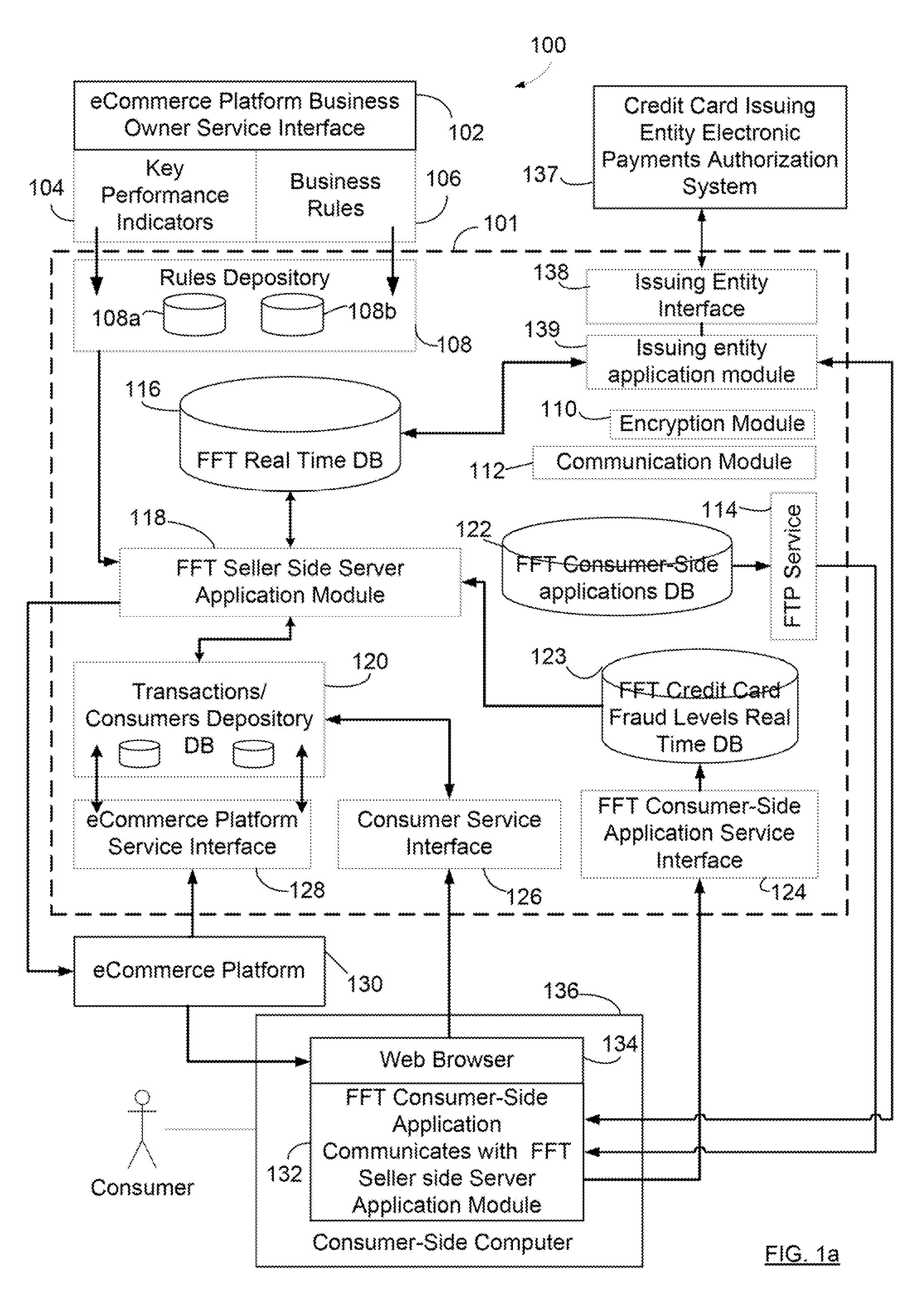

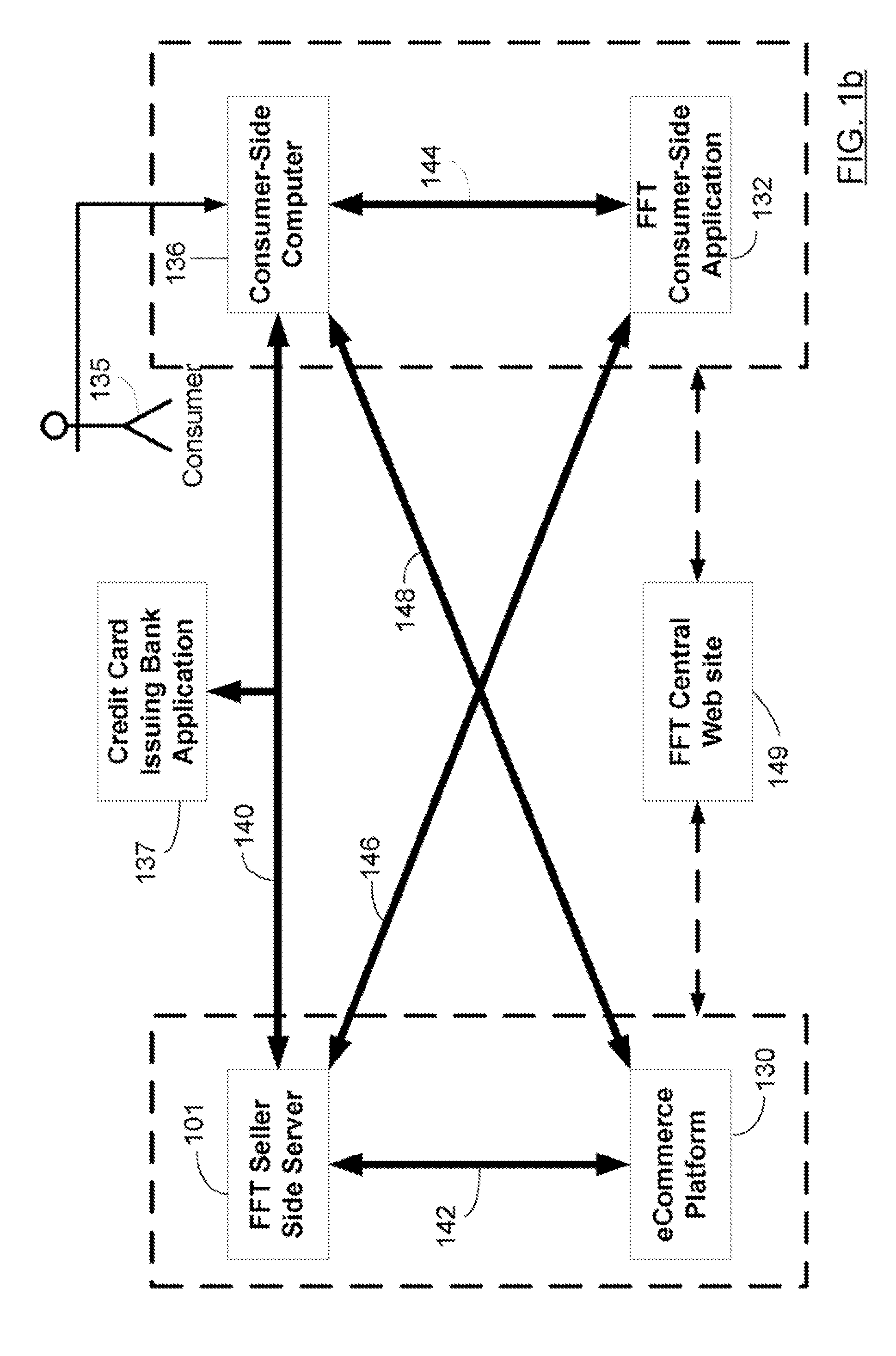

InactiveUS20100106611A1Reduce percentageFinanceApparatus for meter-controlled dispensingPayment transactionService provision

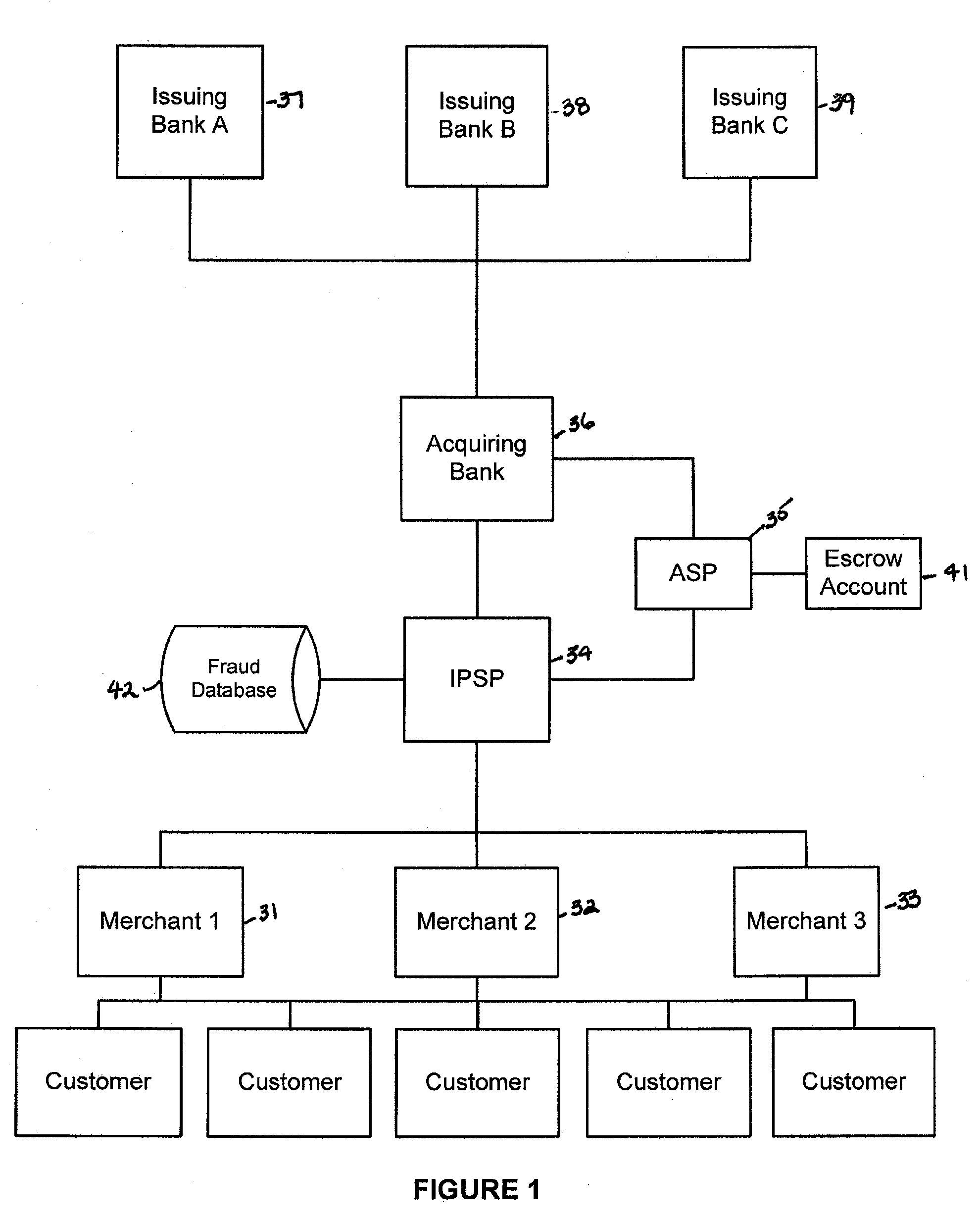

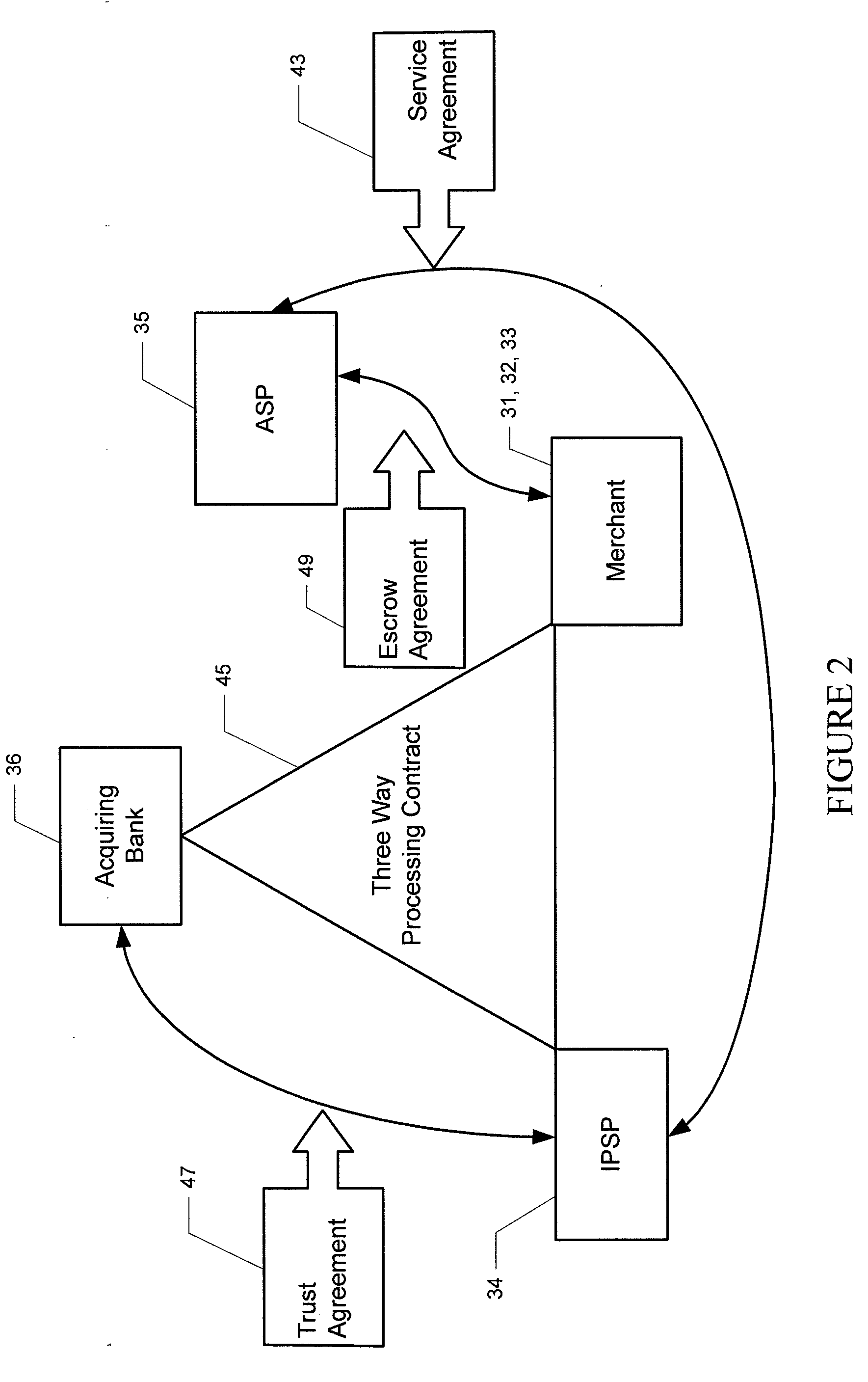

Various embodiments of the invention provide a more secure financial transaction system for e-commerce sectors that (1) more securely processes payment transactions, (2) helps to protect merchants and banks against fraudulent transactions, money laundering, and underage gambling, and (3) helps to limit other abuses in areas of e-commerce that are perceived to pose special risks, such as Internet gaming, travel, and consumer purchasing of electronic goods. To accomplish the above goals, various embodiments of the financial transaction system (1) establish operating and transaction processing protocols for merchants, Internet payment service providers, acquiring banks, and card schemes and (2) provide automated systems for monitoring and securely processing payment and financial transactions.

Owner:TRUST PAYMENTS LTD

Smart communication device secured electronic payment system

InactiveUS20130204793A1Prevent fraudMinimizes likelihood of liabilityFinanceAnonymous user systemsPayment transactionDocumentation

Systems, apparatuses, and methods enabling secure payment transactions, and methods for sharing secure documents, via a mobile device, for example a mobile telephone, smartphone, cellular telephone, other wireless device, a Near Field Communications (NFC) device, or the like. Actual user account information is substituted with temporary account information such that the temporary account information may be manipulated in a manner similar to actual user account information, with the result that actual account information is masked thereby greatly reducing the likelihood of misuse.

Owner:KERRIDGE KEVIN S +1

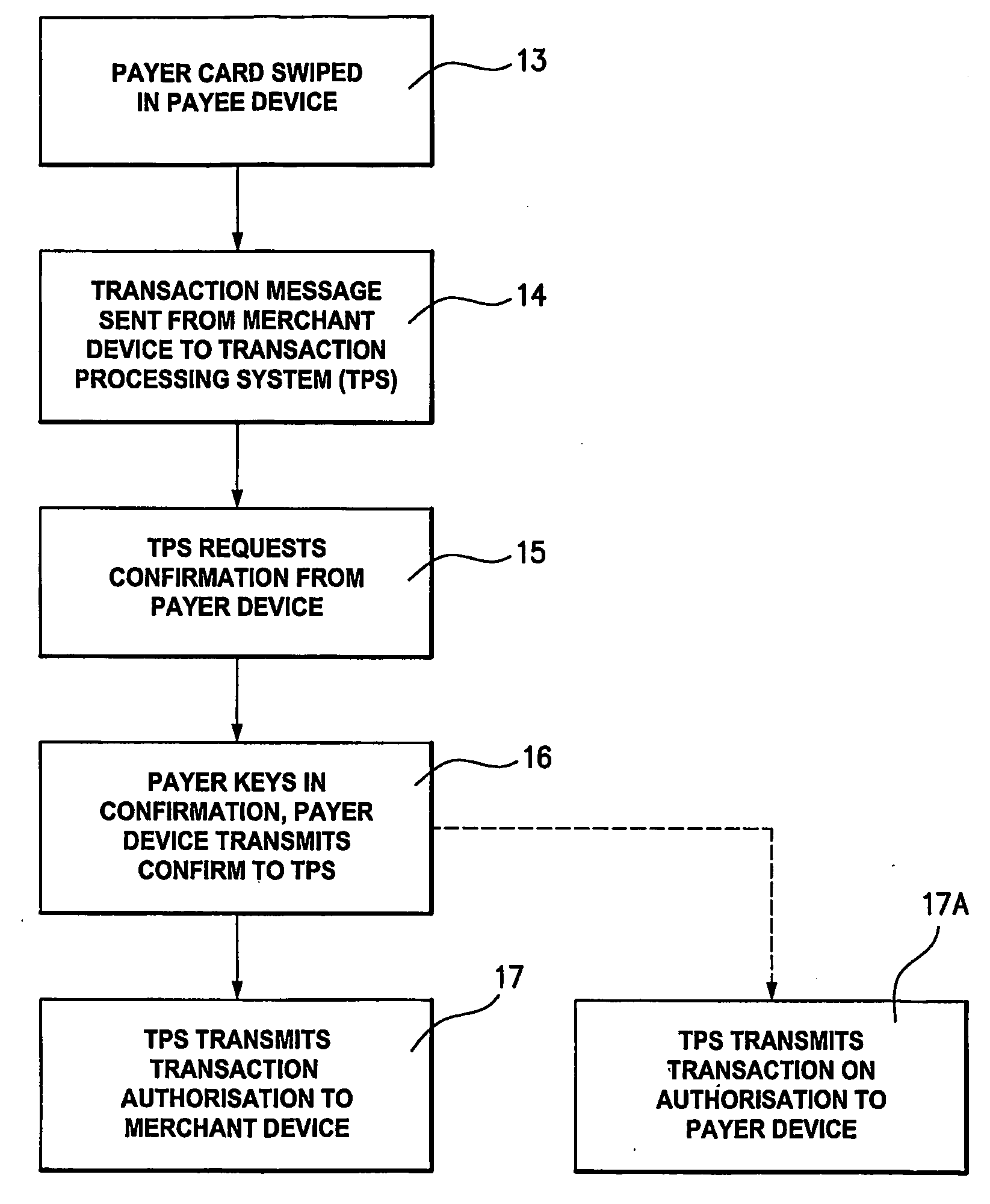

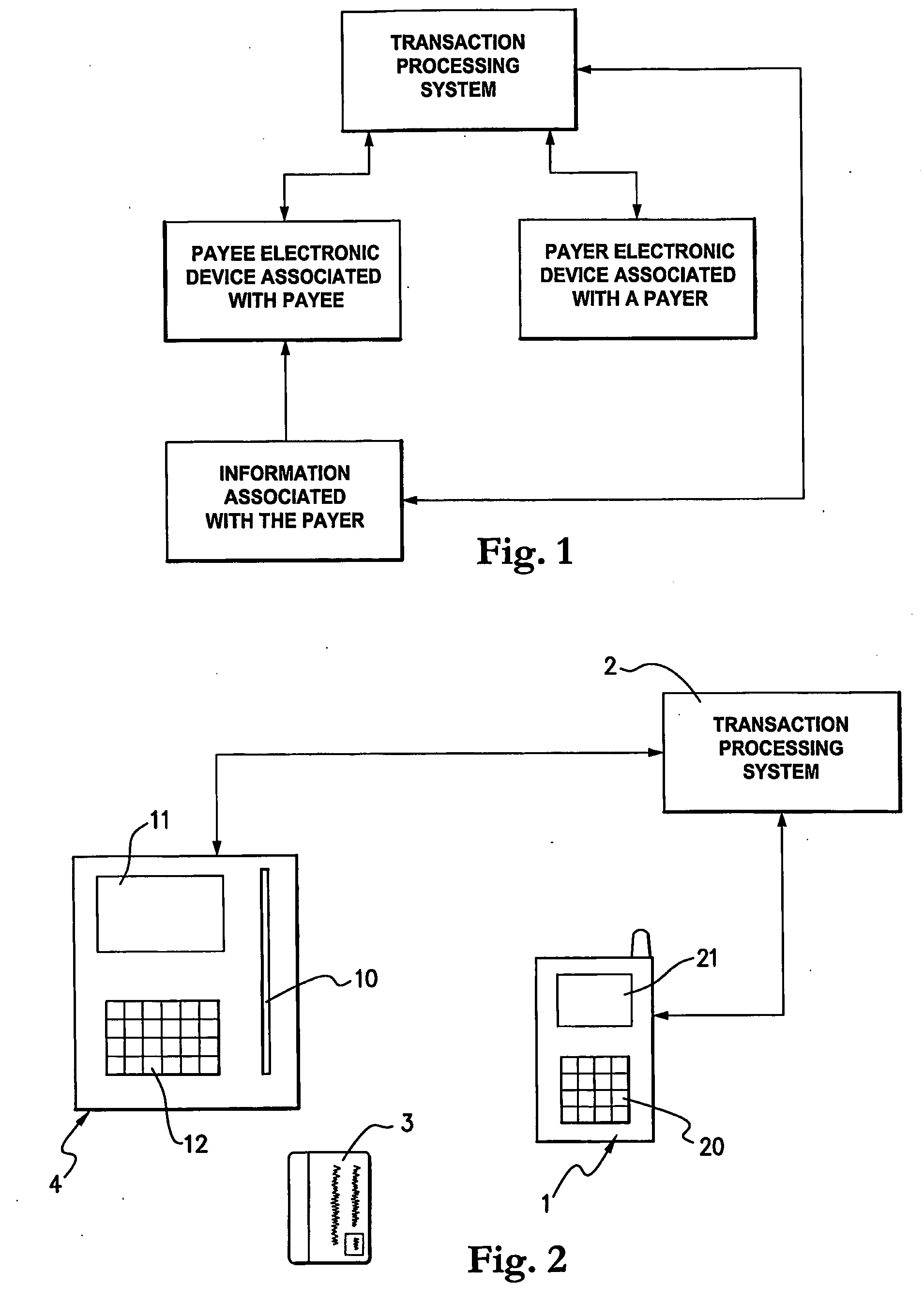

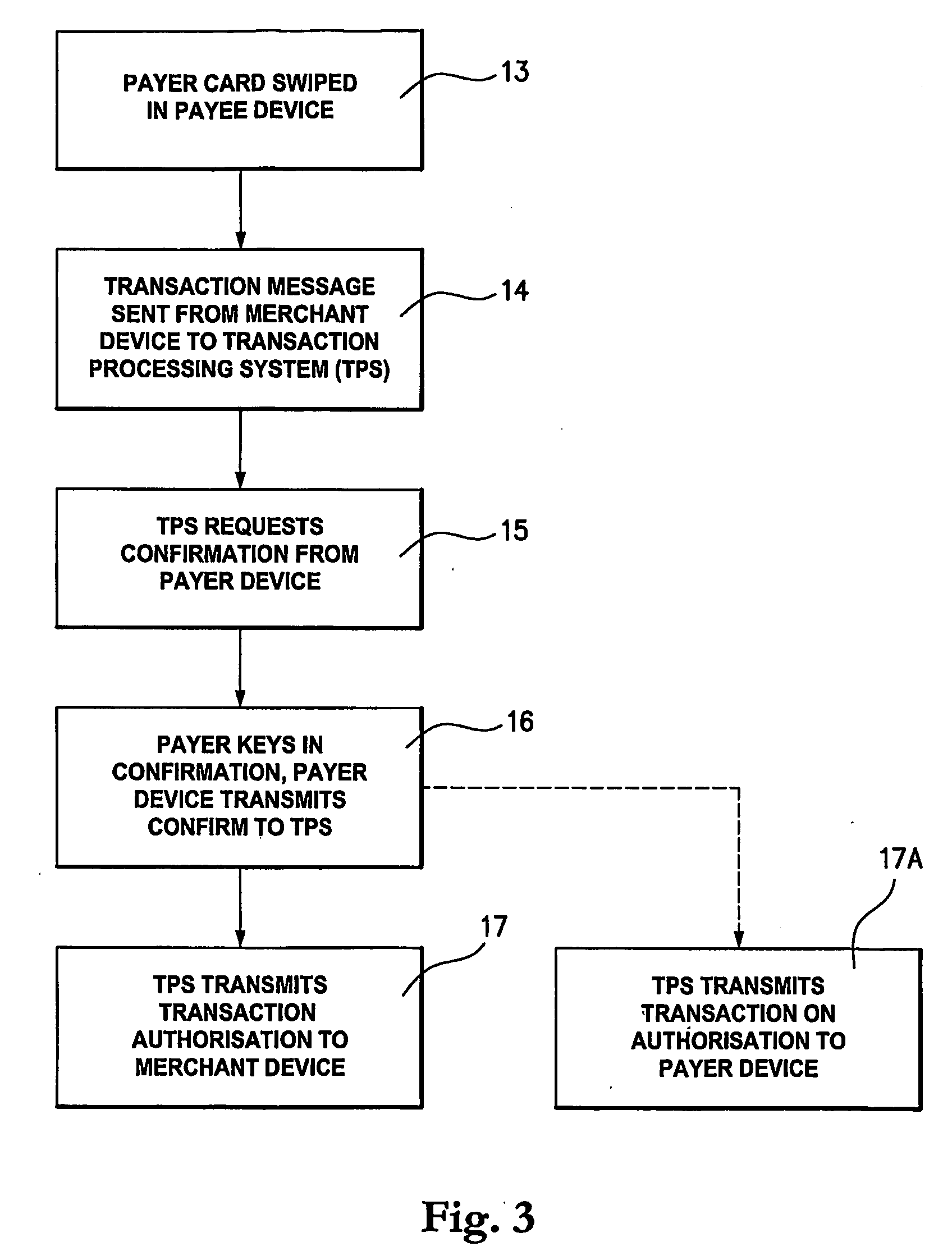

Transaction Processing Method, Apparatus and System

InactiveUS20090099961A1Takes burdenImprove securityComplete banking machinesFinanceIssuing bankPayment transaction

The present invention relates to transaction processing, for processing of payments between payer's (usually individual payers) and payee's (usually merchants. Conventionally, a payment transaction involves a user's account details being provided to a merchant device, e.g. by swiping a card in the card swipe of the merchant device. The merchant device then prepares a transaction message including information such as the user's account ID, merchant ID and payment information and forwards that message to a transaction processing system, which may comprise a transaction acquirer and an issuing bank. The transaction processing system approves the payment and returns confirmation to the merchant. In the present invention a device associated with the payer, which in a preferred embodiment is a suitably adapted mobile telephone, becomes involved in the payment transaction process. At one level, the transaction processing system requests from the payer electronic device confirmation that the transaction should proceed and the payer keys in an appropriate PIN to authorise the transaction. At another level, all the transaction processing information is provided from the payer electronic device to the transaction processing system and the transaction processing system or the payer electronic device then confirm that the transaction is authorised to the merchant device. This takes the burden of transaction processing off the merchant and also increases the security of the transaction as the payer is in control. In a further embodiment, the payer electronic device may also upload listings of products and select products at the same time as paying for them, the payee (merchant) being advised of the selected product.

Owner:OGILVY IAN CHARLES

Systems and Methods for Automatic and Transparent Client Authentication and Online Transaction Verification

Systems and methods are described for providing fraud deterrents, detection and prevention during e-commerce, e-transactions, digital rights management and access control. Fraud deterrent levels may be automatically selected by a requesting transaction approval entity server (and can be related to level of risk, or security, related to fraud) or may be selected by a consumer. These deterrent levels can determine the manner in which the transaction occurs as well as the types of information that must be provided and validated for successful approval of the transaction. The client can associate their credit card with a specific device, an e-identity, such as an instant messaging identity, and the e-identity is contacted as a part of finalizing a payment transaction so that a client response of ‘approve’ or ‘reject’ can be obtained. The anti-fraud technology also provides for management and storage of historical transaction information. Entity-to-client communication occurs according to merchant permission parameters which are defined by the client and which enable messages sent by the entity to be automatically allowed, rejected, and managed in other ways as well.

Owner:JOHN MICHAEL SASHA

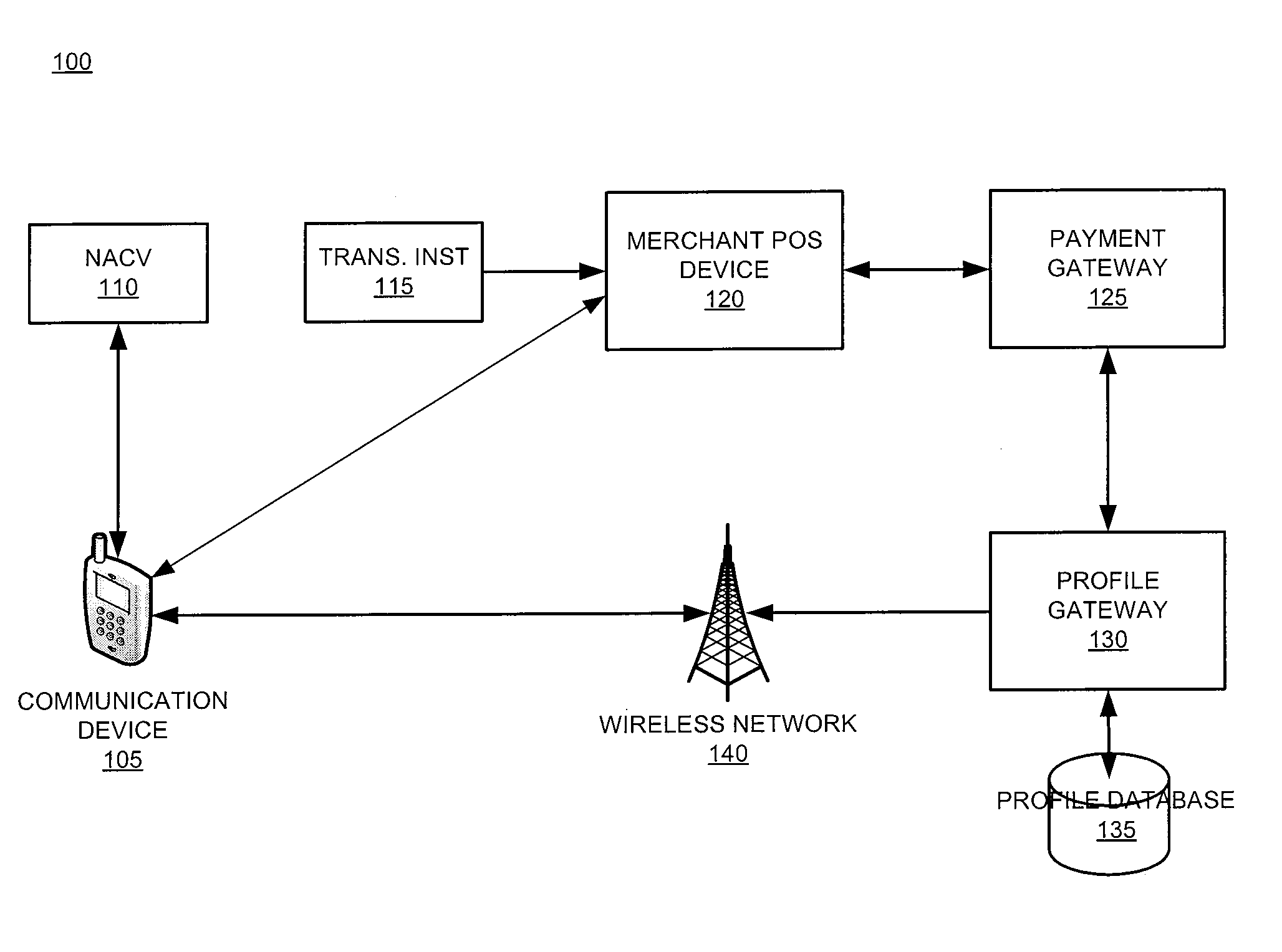

System and device for facilitating a transaction through use of a proxy account code

InactiveUS20110246317A1Increase dependenceFacilitating secure and convenient electronic transactionsFinancePoint-of-sale network systemsPayment transactionSmart card

The present invention relates generally to a smart card device that is configured to facilitate wireless network access and credential verification. Specifically, the device is configured to meet the physical and electrical specification for commercially available mobile devices utilizing a standard Subscriber Identity Module (SIM) for network access. The device combines the features of the SIM with Common Access Card or Personal Identity Verification card features to allow a network subscriber to invoke secure payment transactions over a carrier's network. The system includes data storage for maintaining a plurality of network and transaction instrument profiles and a profile gateway for receiving transaction information from a payment gateway, sending an authorization request to a user's mobile device, receiving a transaction authorization from the mobile device, and sending transaction information to a payment gateway to finalize the payment transaction.

Owner:APRIVA

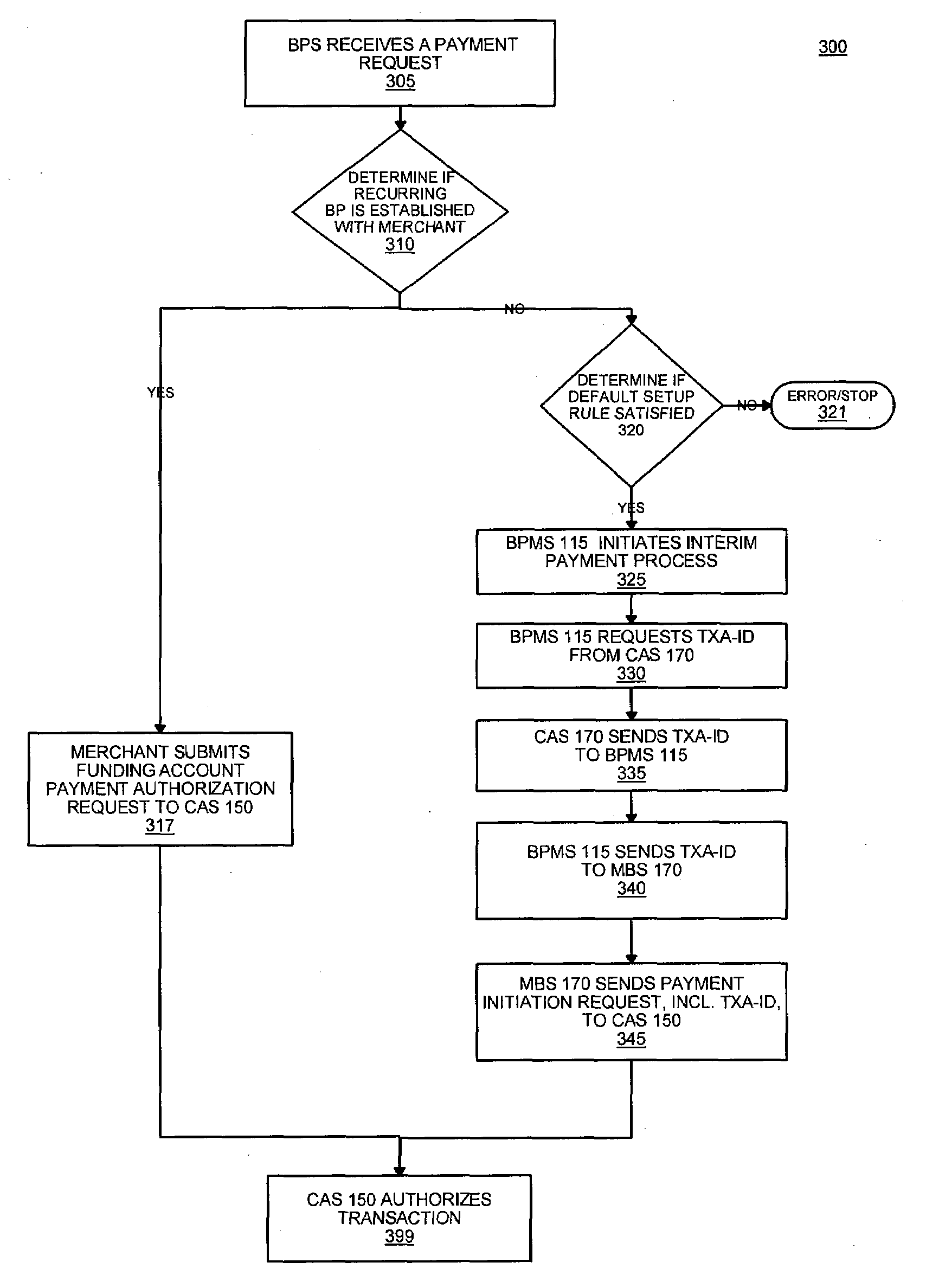

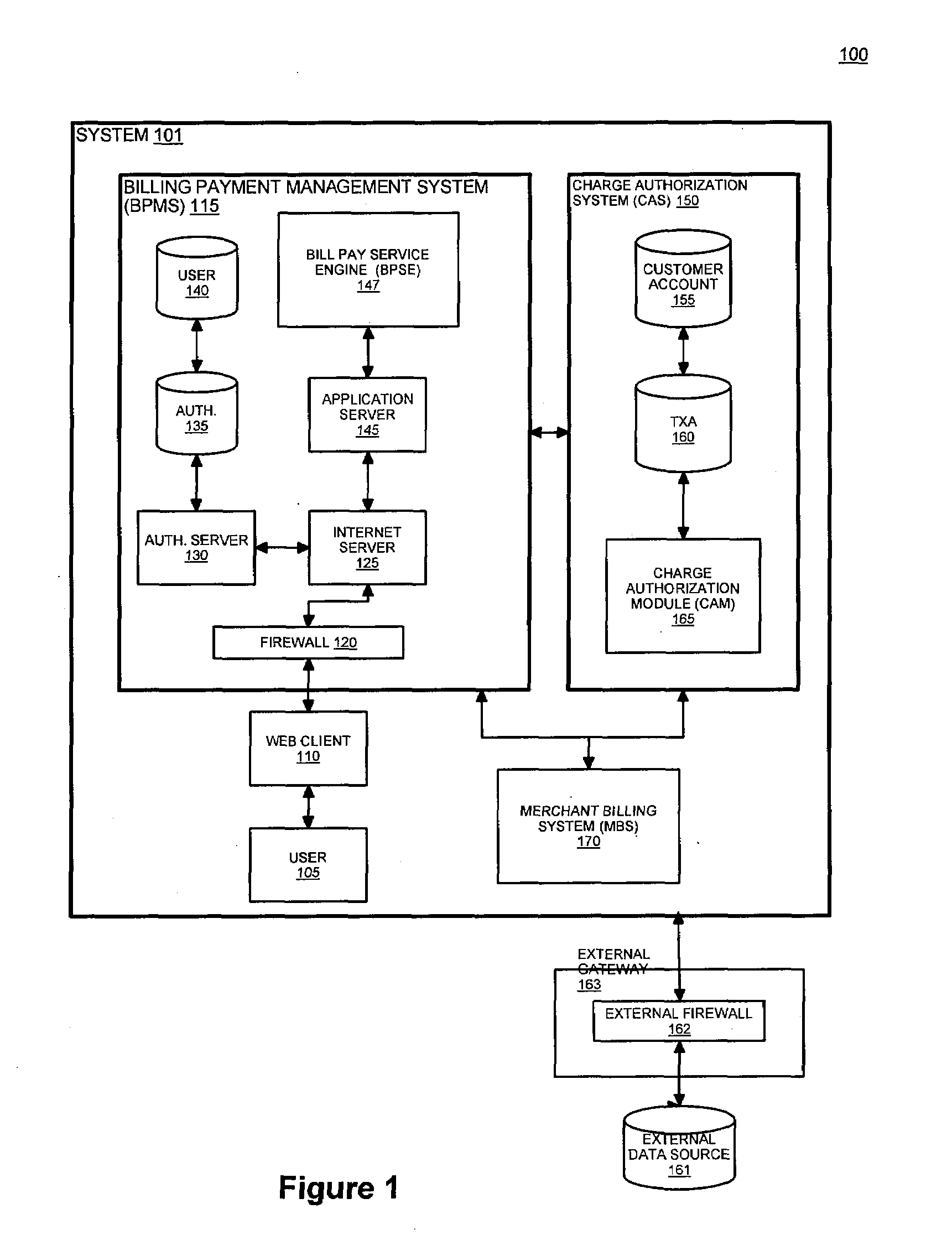

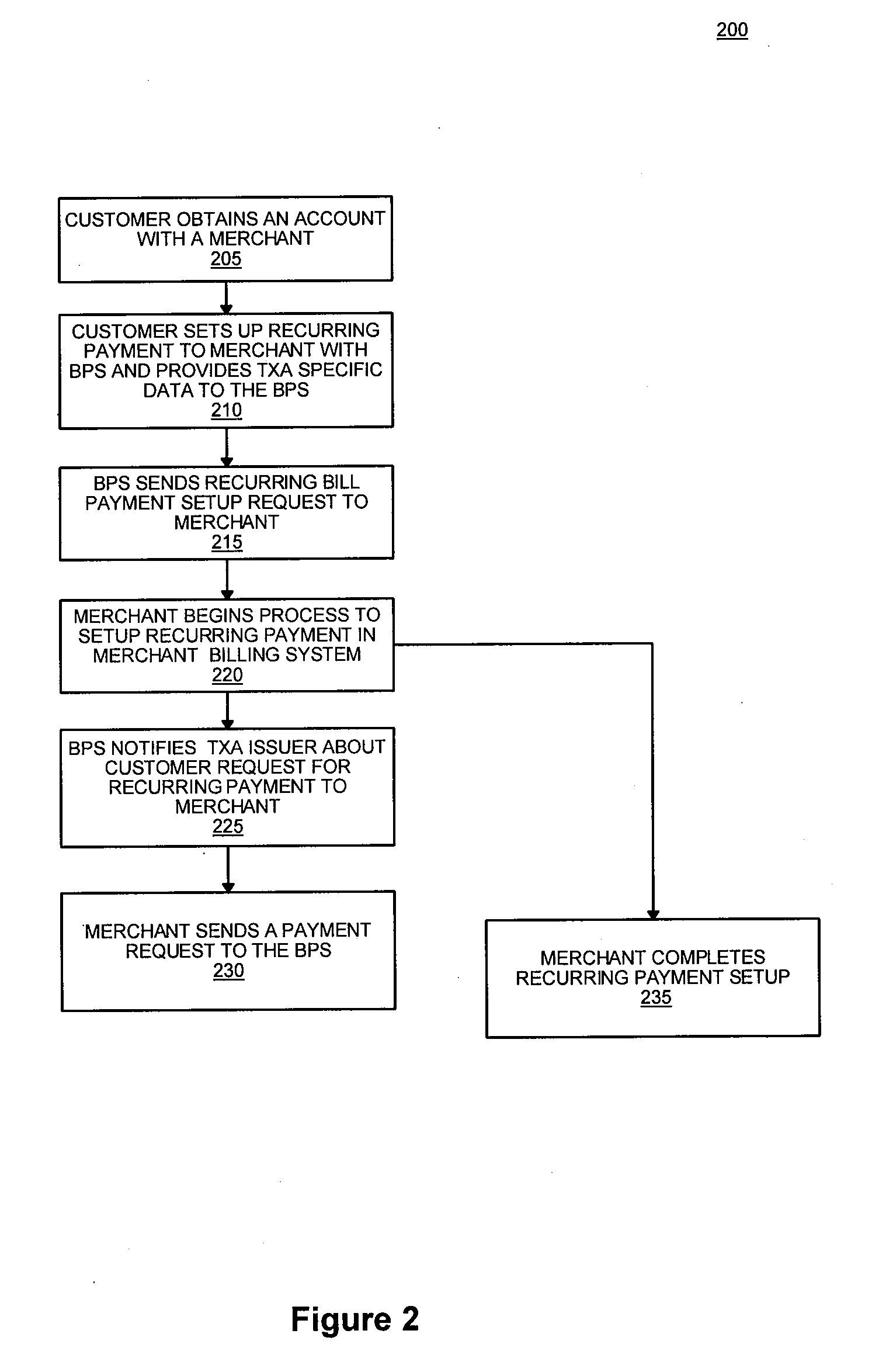

Bill payment system and method

Automated authorization and processing of an interim payment is disclosed. When a merchant requests payment prior to a recurring payment process being enabled, the system handles the payment request without customer intervention. The system requests and receives a transaction coordination code for an interim payment from a financial processor. The system passes the interim payment transaction coordination code to the merchant so the merchant may obtain an authorized payment.

Owner:LIBERTY PEAK VENTURES LLC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com