Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

587 results about "Transaction service" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Transactional services

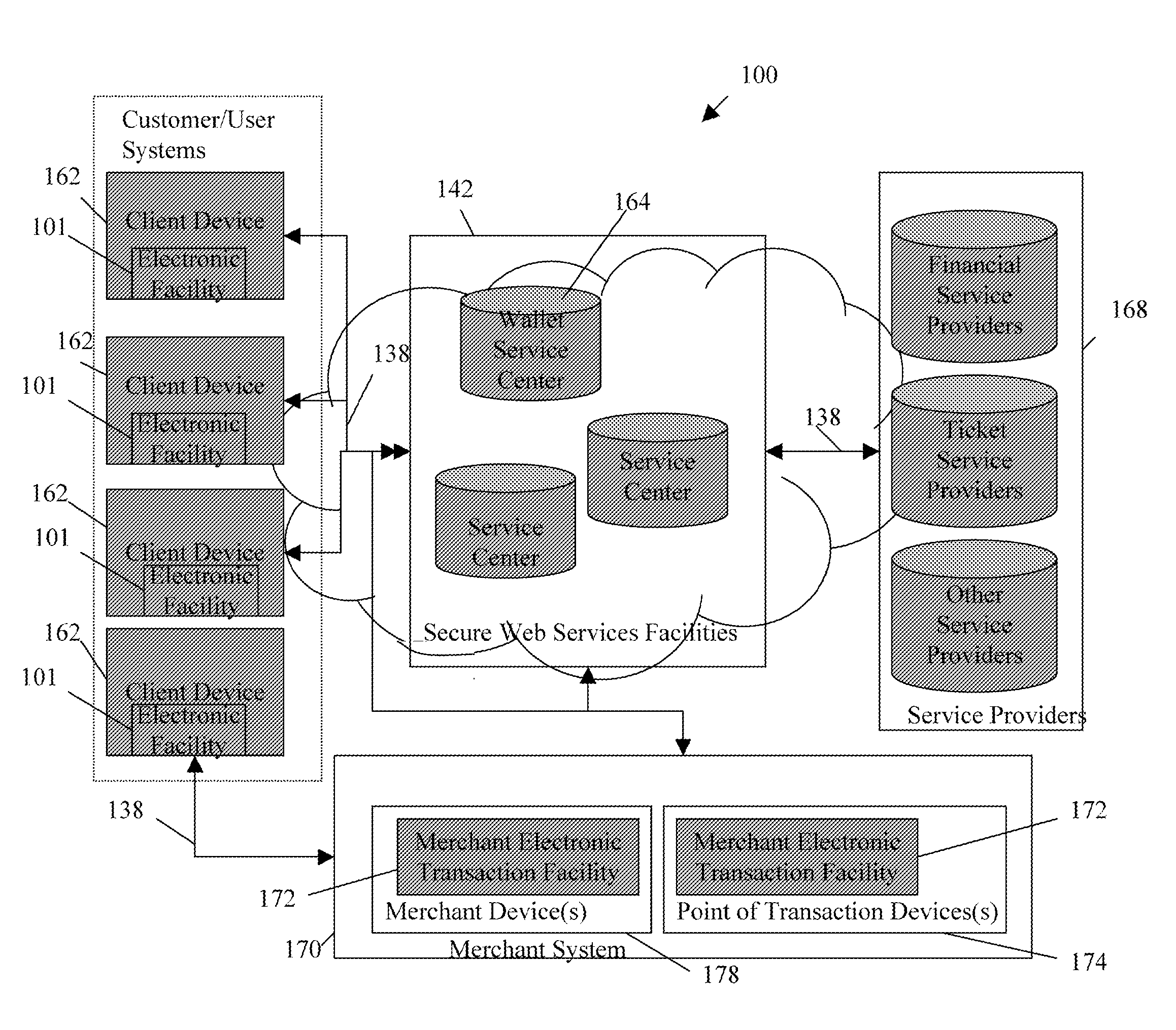

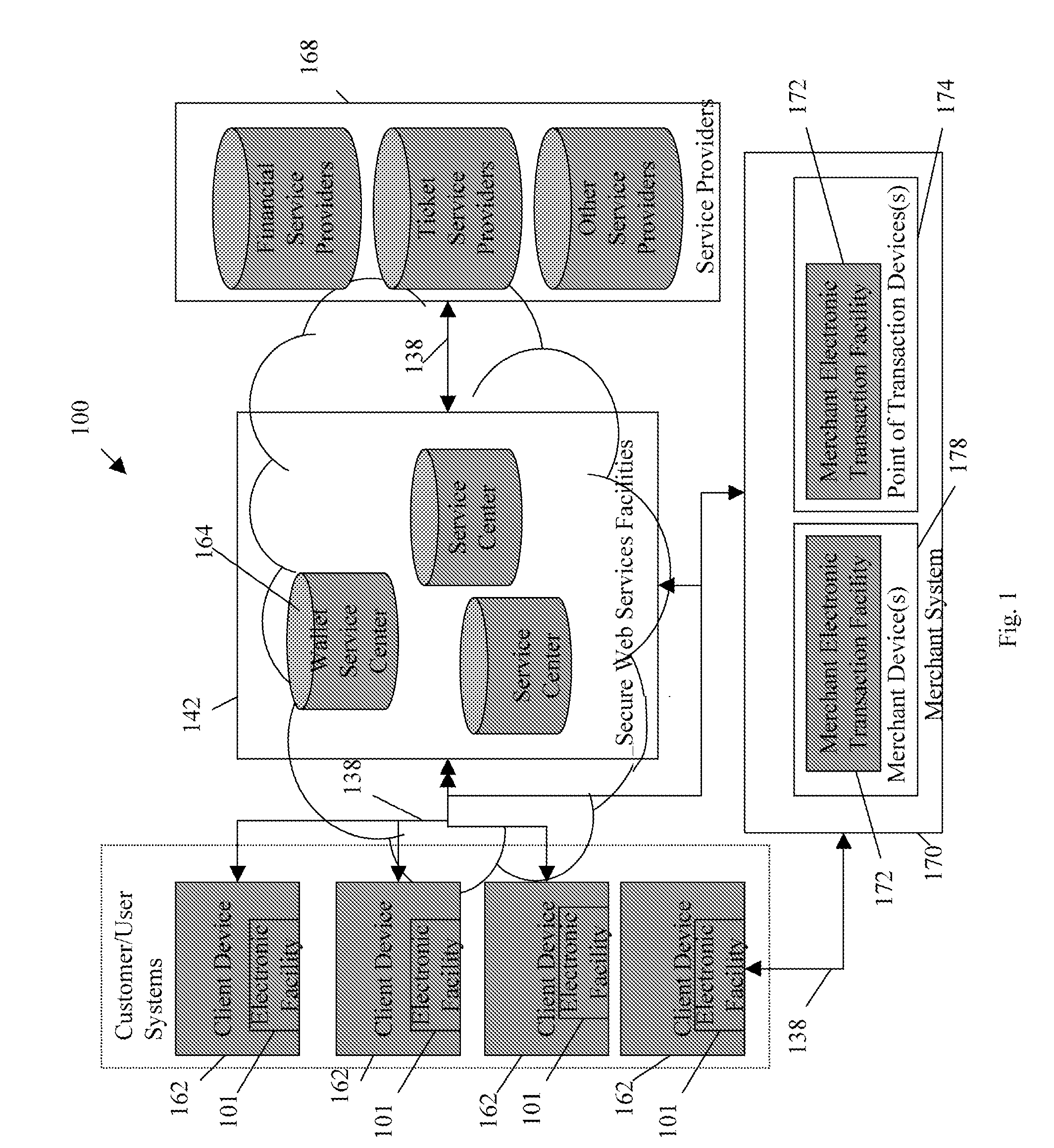

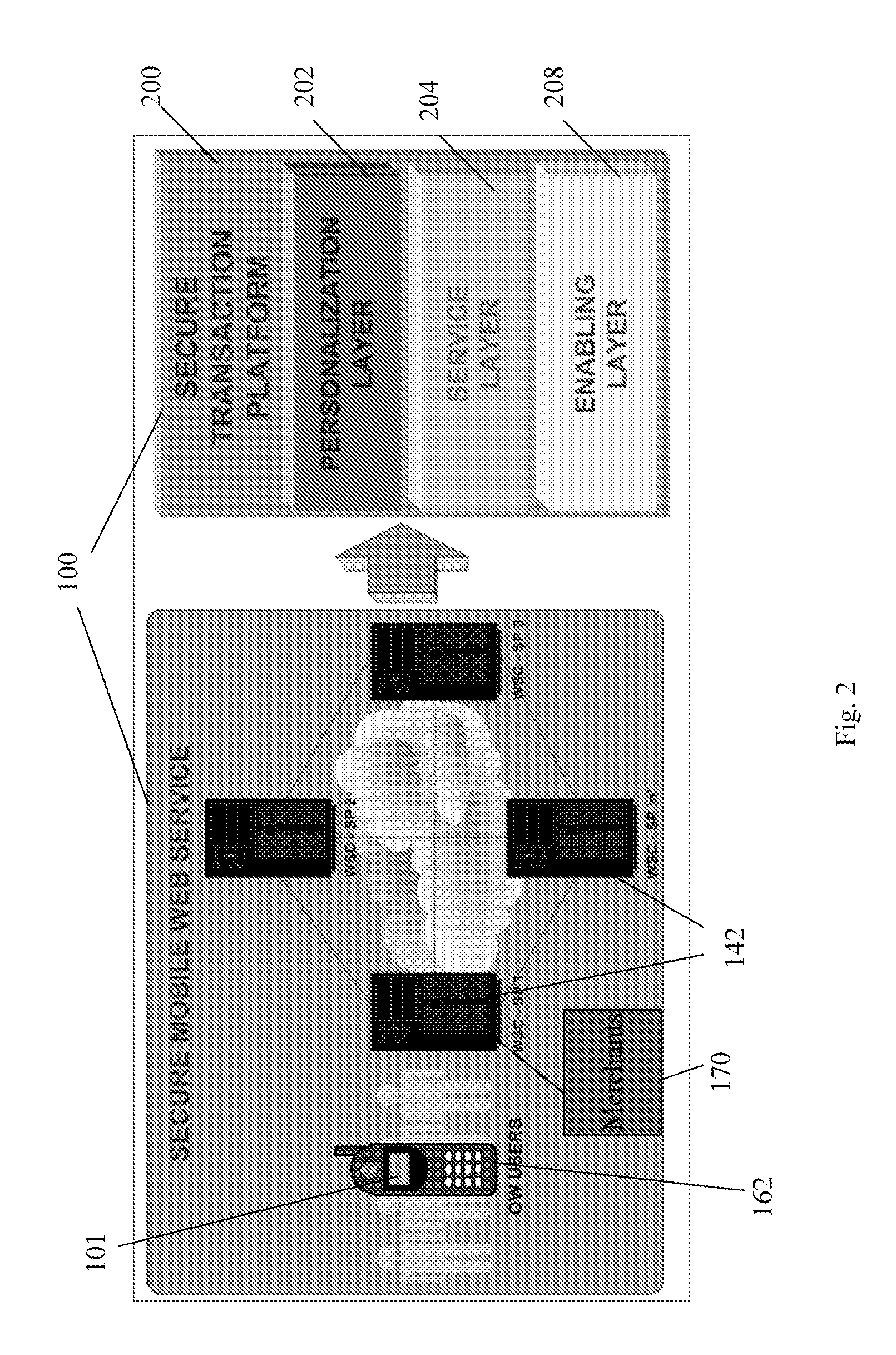

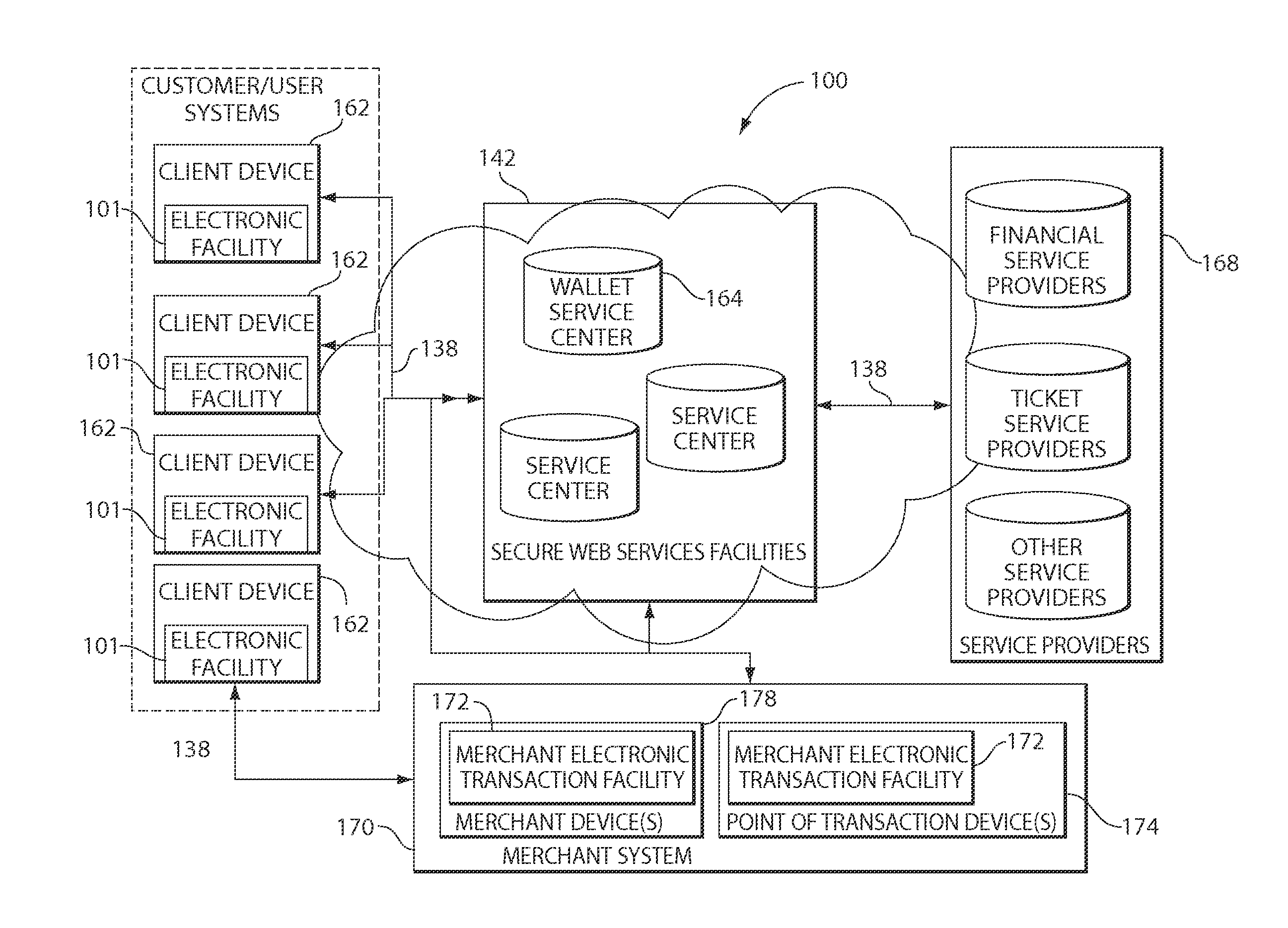

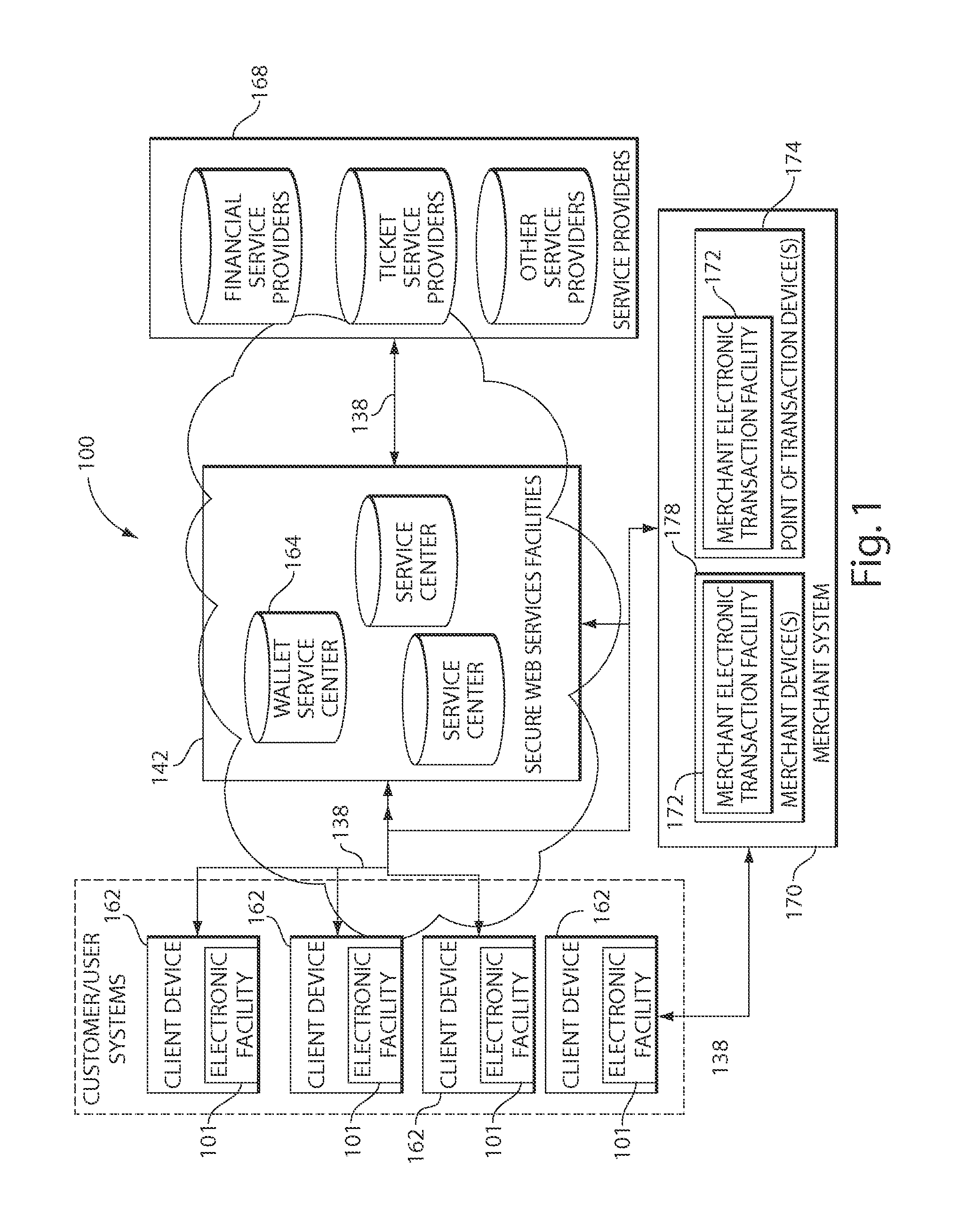

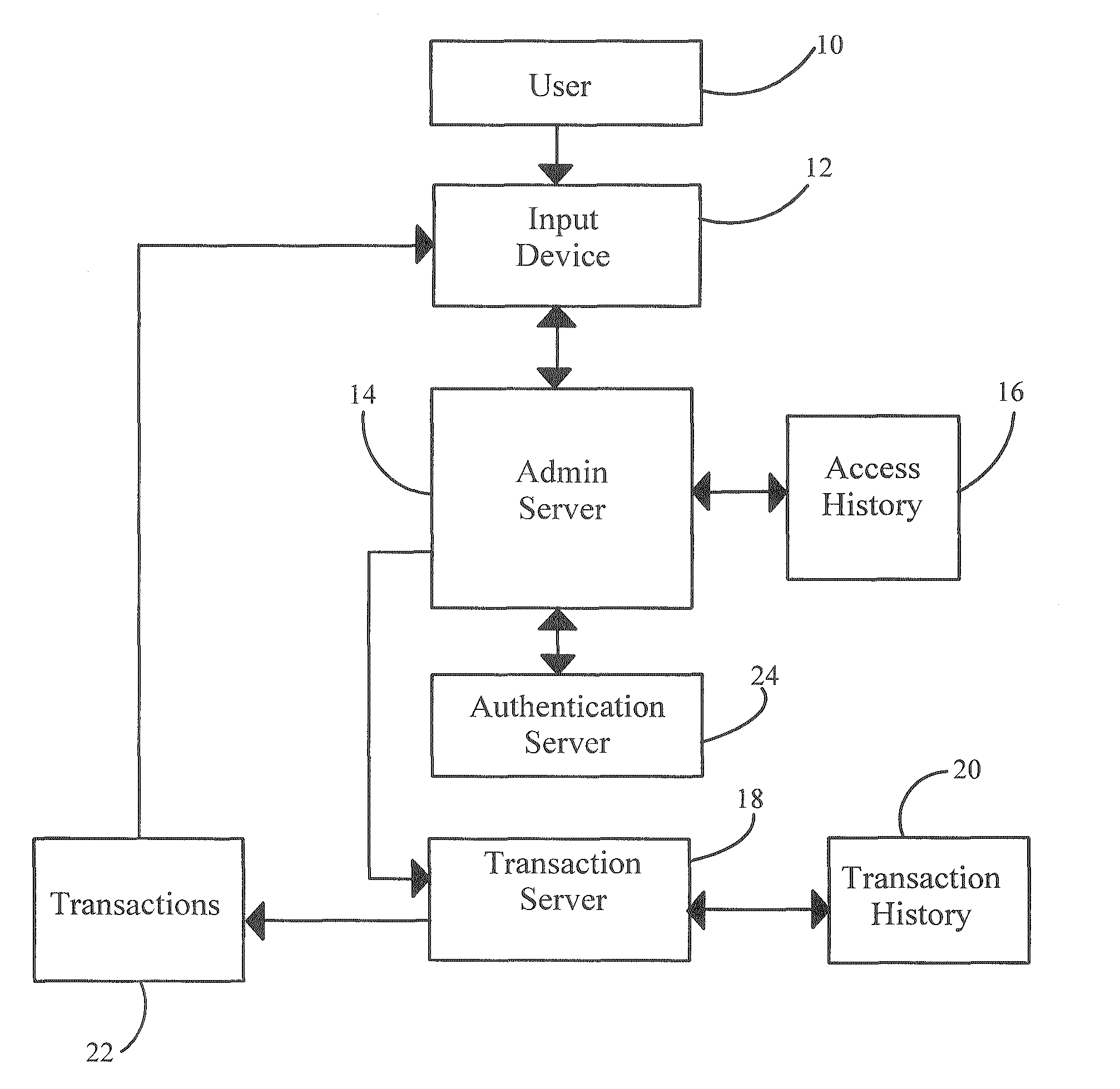

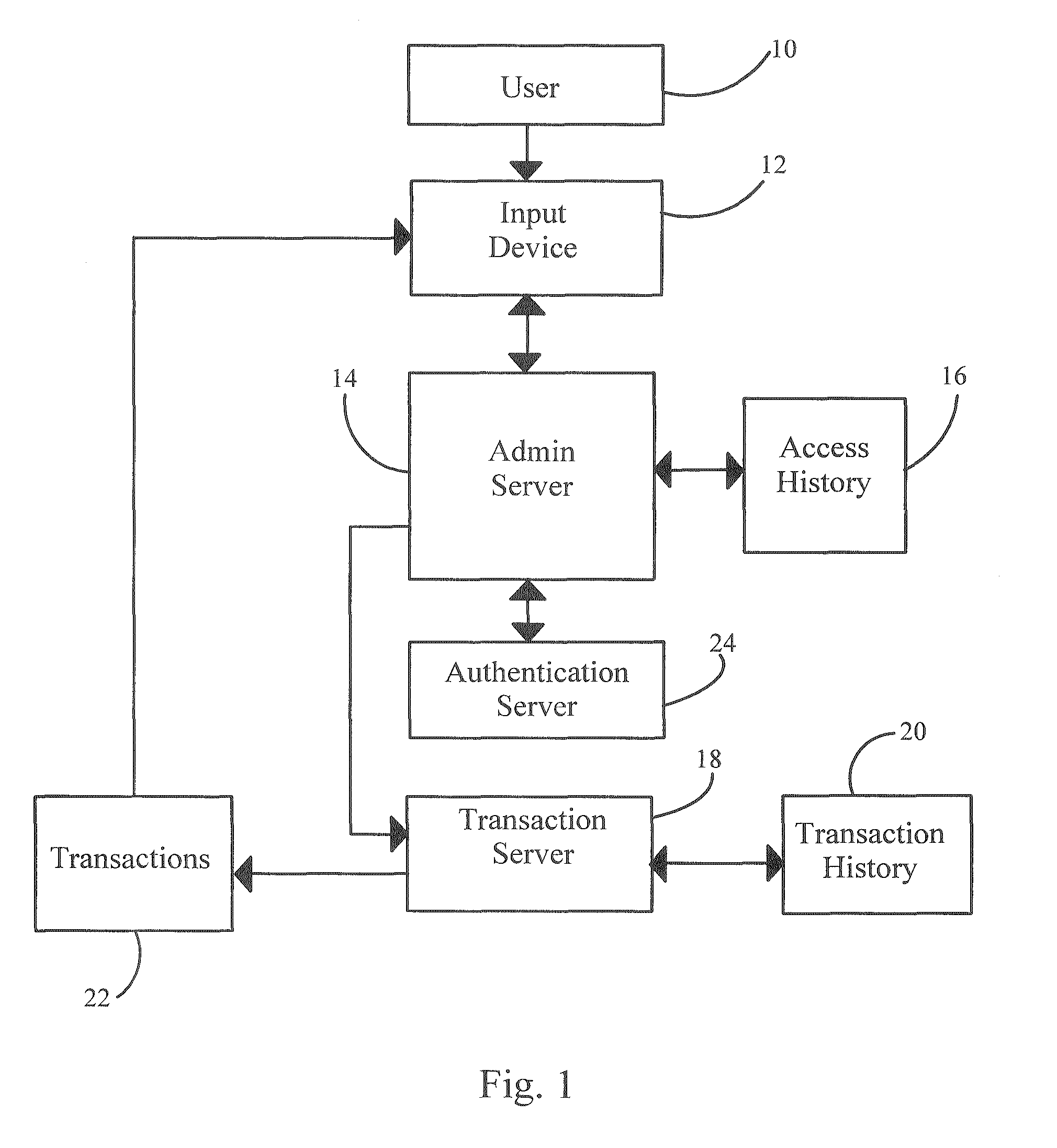

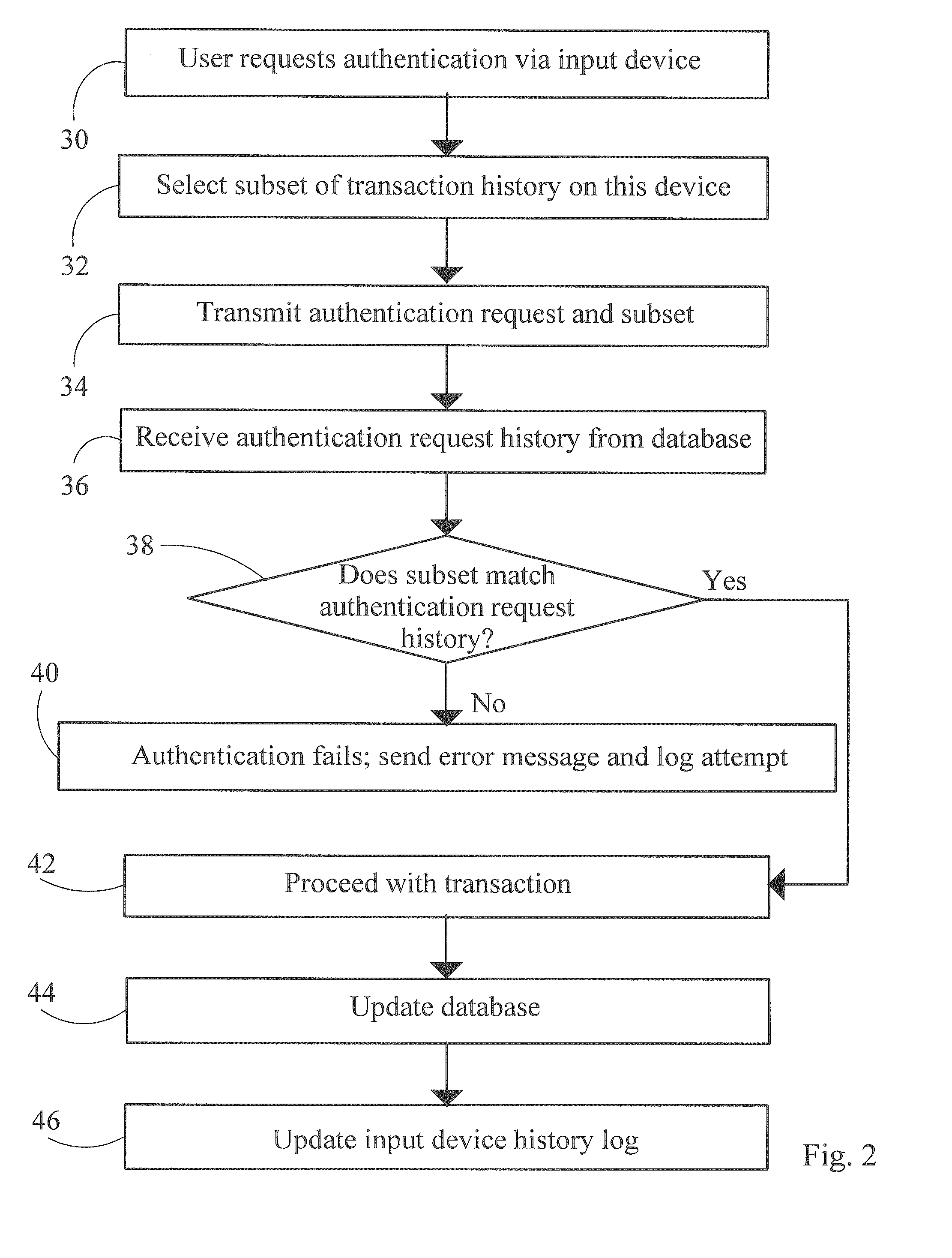

InactiveUS20070198432A1High level of throughputHigh level of efficiencyCryptography processingComputer security arrangementsTransaction serviceDatabase

Owner:MASTERCARD MOBILE TRANSACTIONS SOLUTIONS

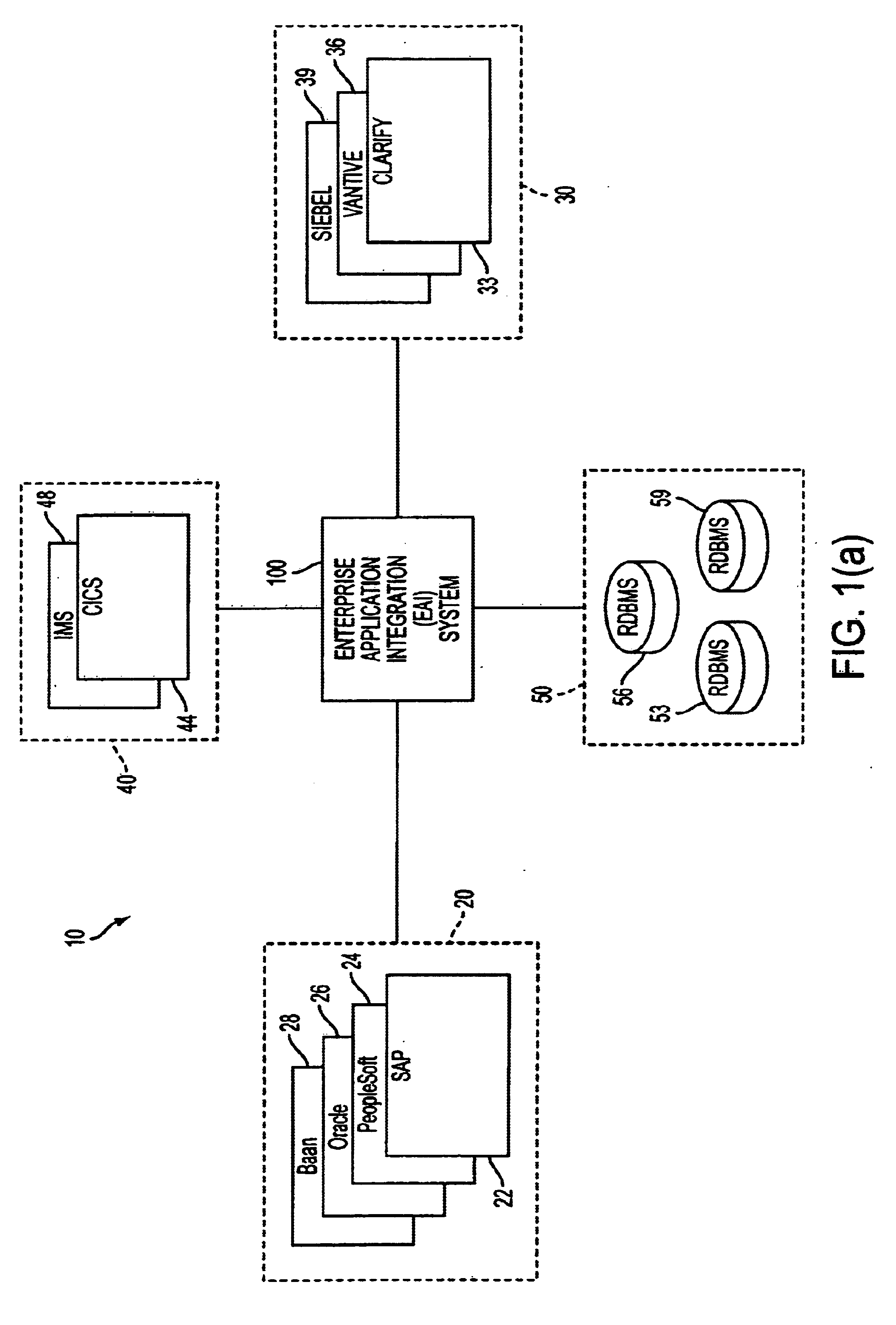

System and method for transaction services patterns in a netcentric environment

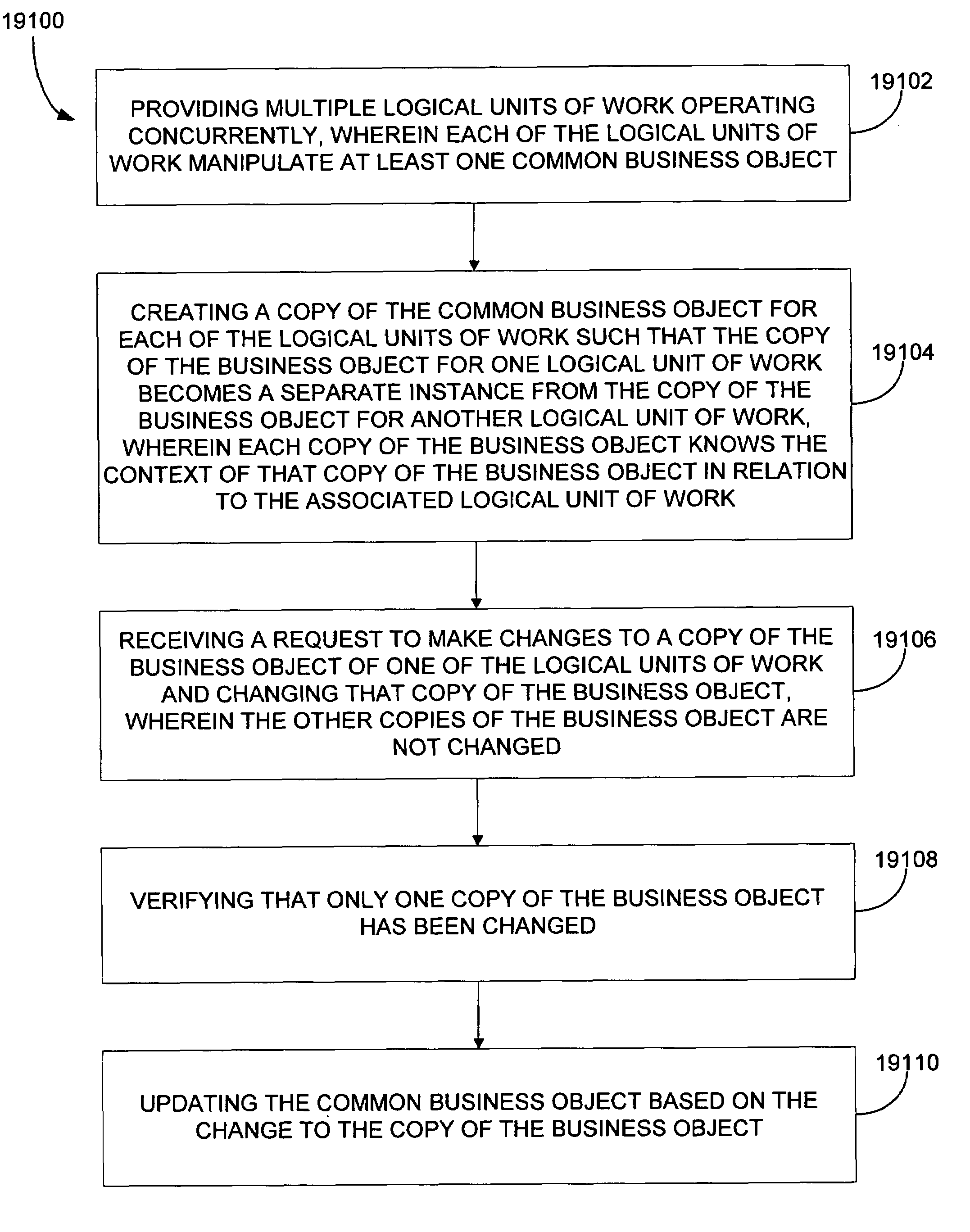

InactiveUS7289964B1Reduce network trafficOffice automationProgram controlTraffic capacityTransaction service

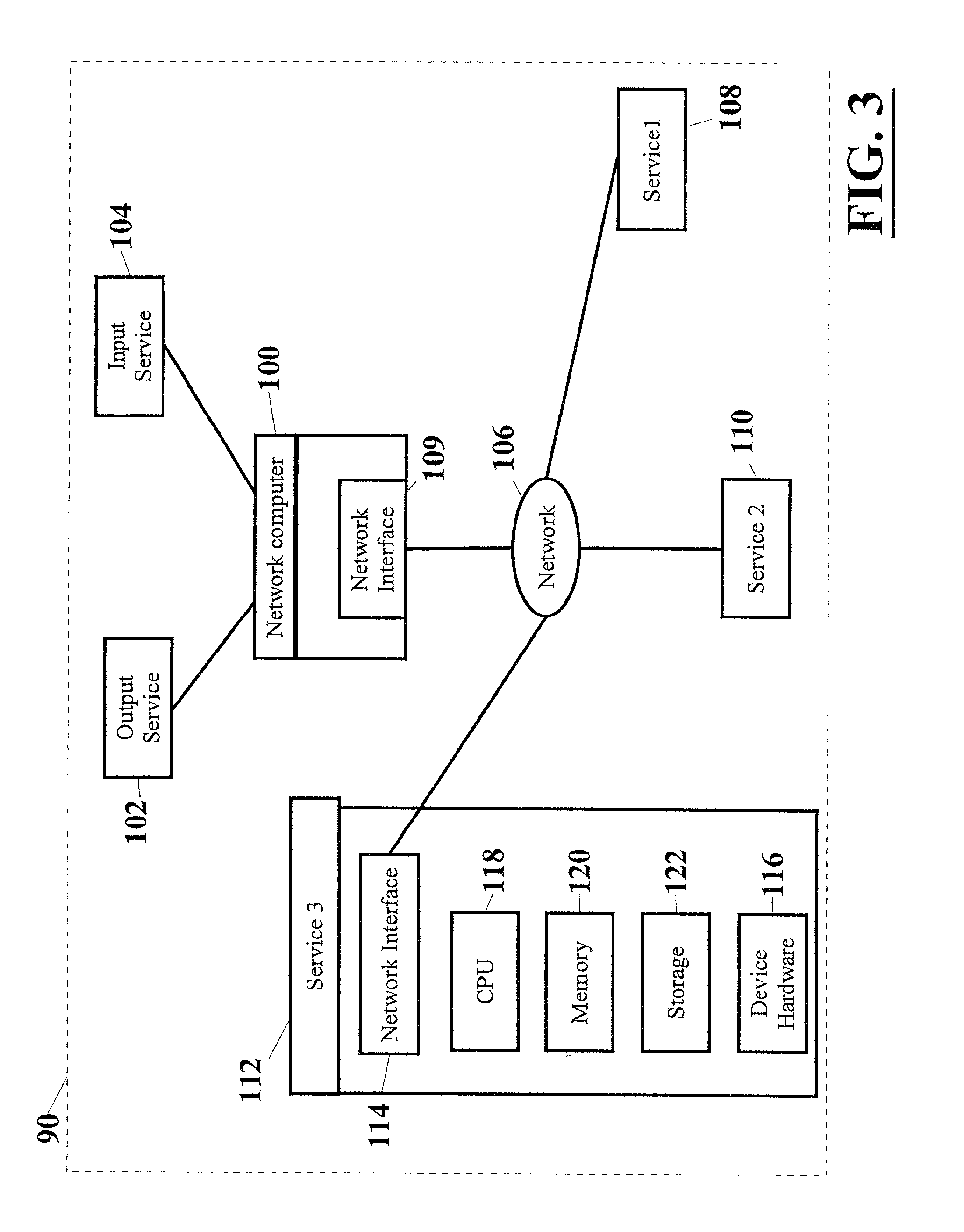

The present disclosure provides for implementing transaction services patterns. Logical requests are batched for reducing network traffic. A batched request is allowed to indicate that it depends on the response to another request. A single message is sent to all objects in a logical unit of work. Requests that are being unbatched from a batched message are sorted. Independent copies of business data are assigned to concurrent logical units of work for helping prevent the logical units of work from interfering with each other.

Owner:ACCENTURE GLOBAL SERVICES LTD

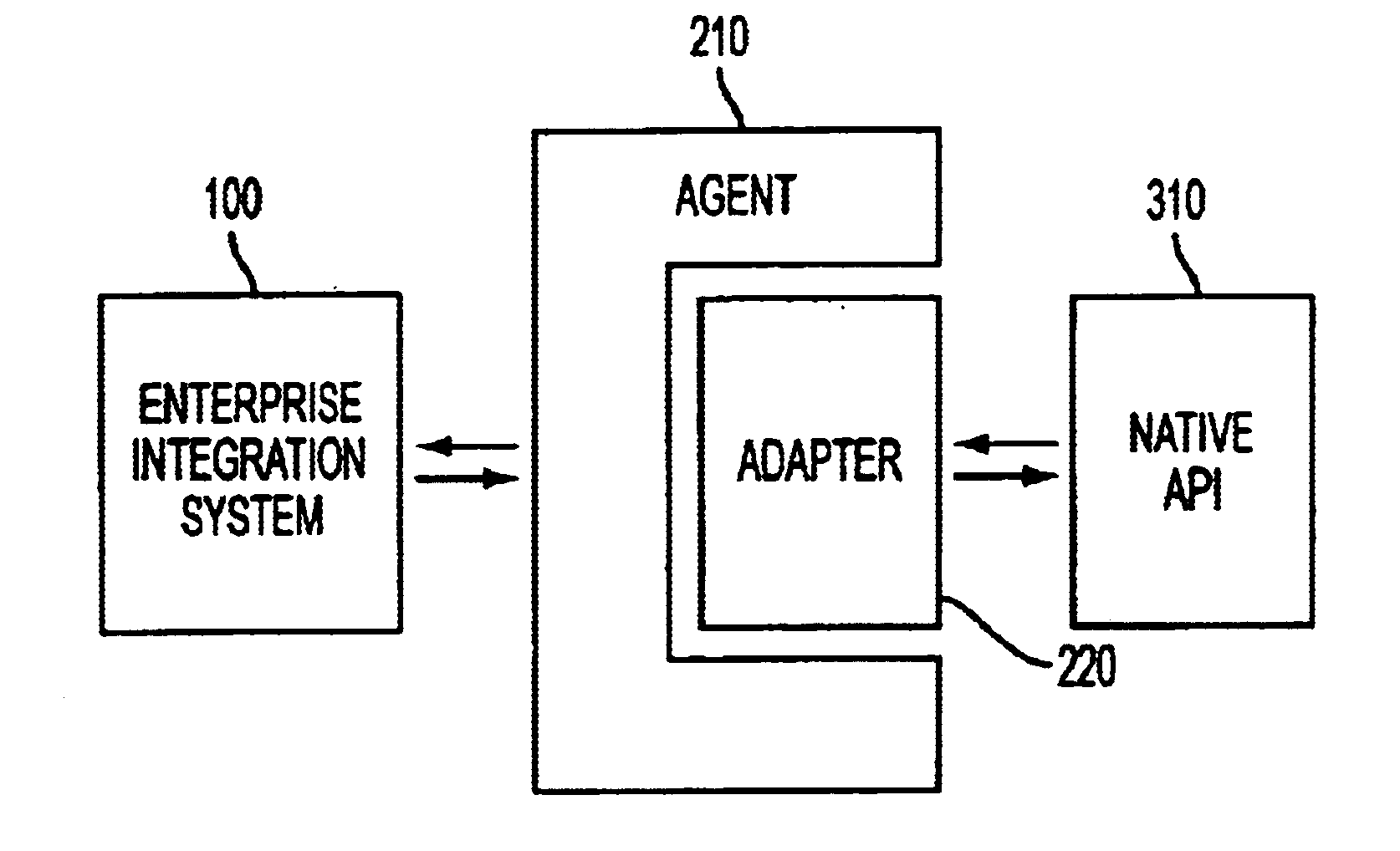

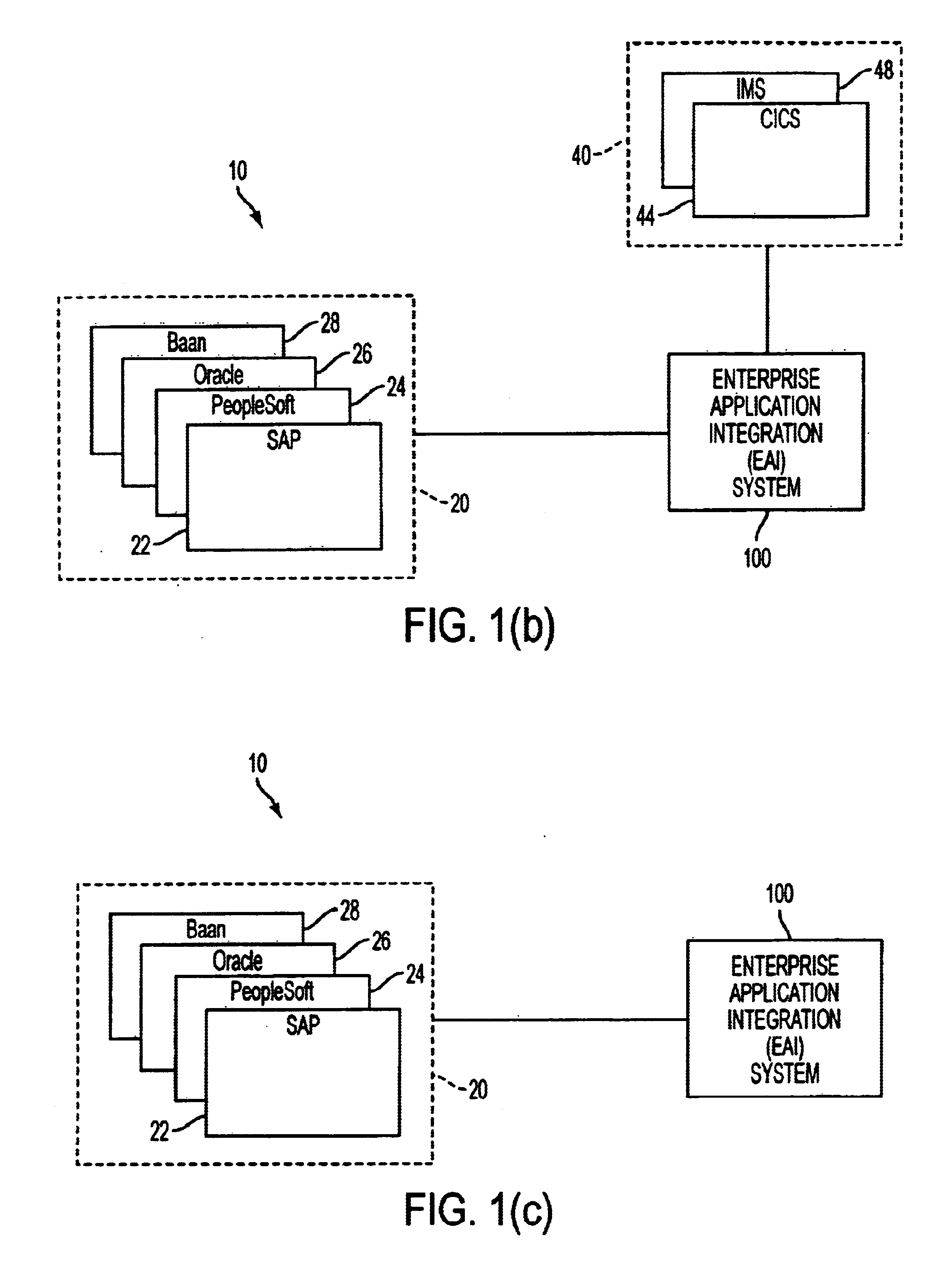

Extensible distributed enterprise application integration system

InactiveUS6738975B1Improve securityImprove the environmentInterprogram communicationMultiple digital computer combinationsTransaction serviceInteroperability

In general, in one aspect, the invention provides a modular application collaborator for providing inter-operability between applications including a plurality of connectors for communicating with a like plurality of applications and an interchange server. The interchange server includes an application collaboration module and service module. The service module transfers messages between connectors and the application collaboration module. The application collaboration defines the inter-operability between two or more applications. The interchange server service module includes a transaction service and an error service. Transactions are executed in the application collaboration module and the transaction service records each action and a compensating action for undoing an associated action. An error service monitors for errors in the interchange server, and, upon detection of an error, stops the execution of a transaction and initiates the execution of any required compensating actions to undo the interrupted transaction. The compensating transactions may be executed at the connectors and are not required to be overseen by the interchange server.

Owner:SAGA SOFTWARE

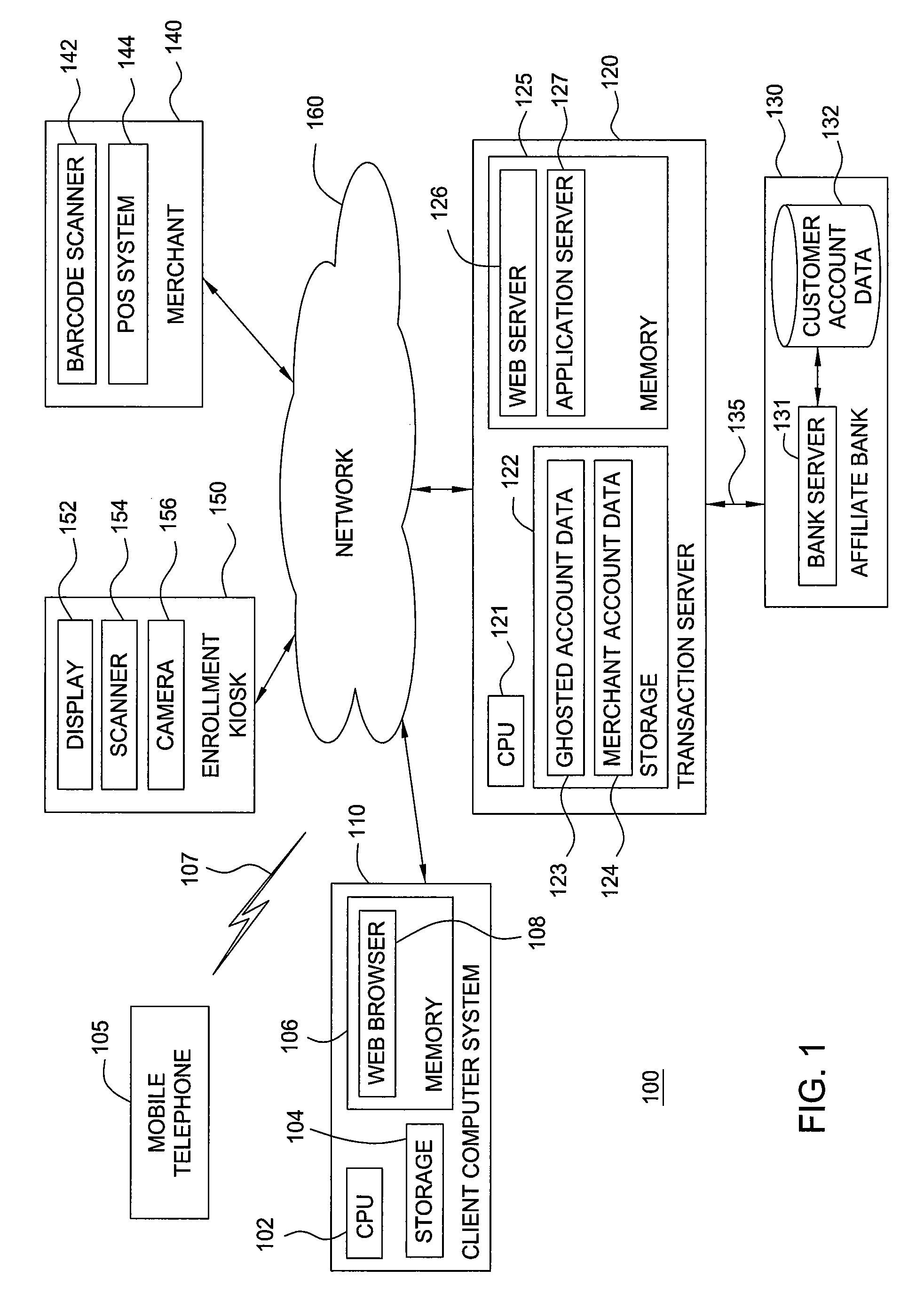

Mobile telephone transaction systems and methods

InactiveUS20090281904A1Hand manipulated computer devicesAccounting/billing servicesTransaction servicePayment transaction

Techniques are disclosed for a mobile telephone, in conjunction with a payment transaction server, to be used directly as a payment device for a variety of financial transactions. Further, the transaction systems and methods for mobile telephone devices described herein allow a mobile telephone to participate in payment transactions in a manner that helps prevent identify theft and without relying on transferring amounts to / from one stored value account to another.

Owner:GLOBAL 1 ENTERPRISES

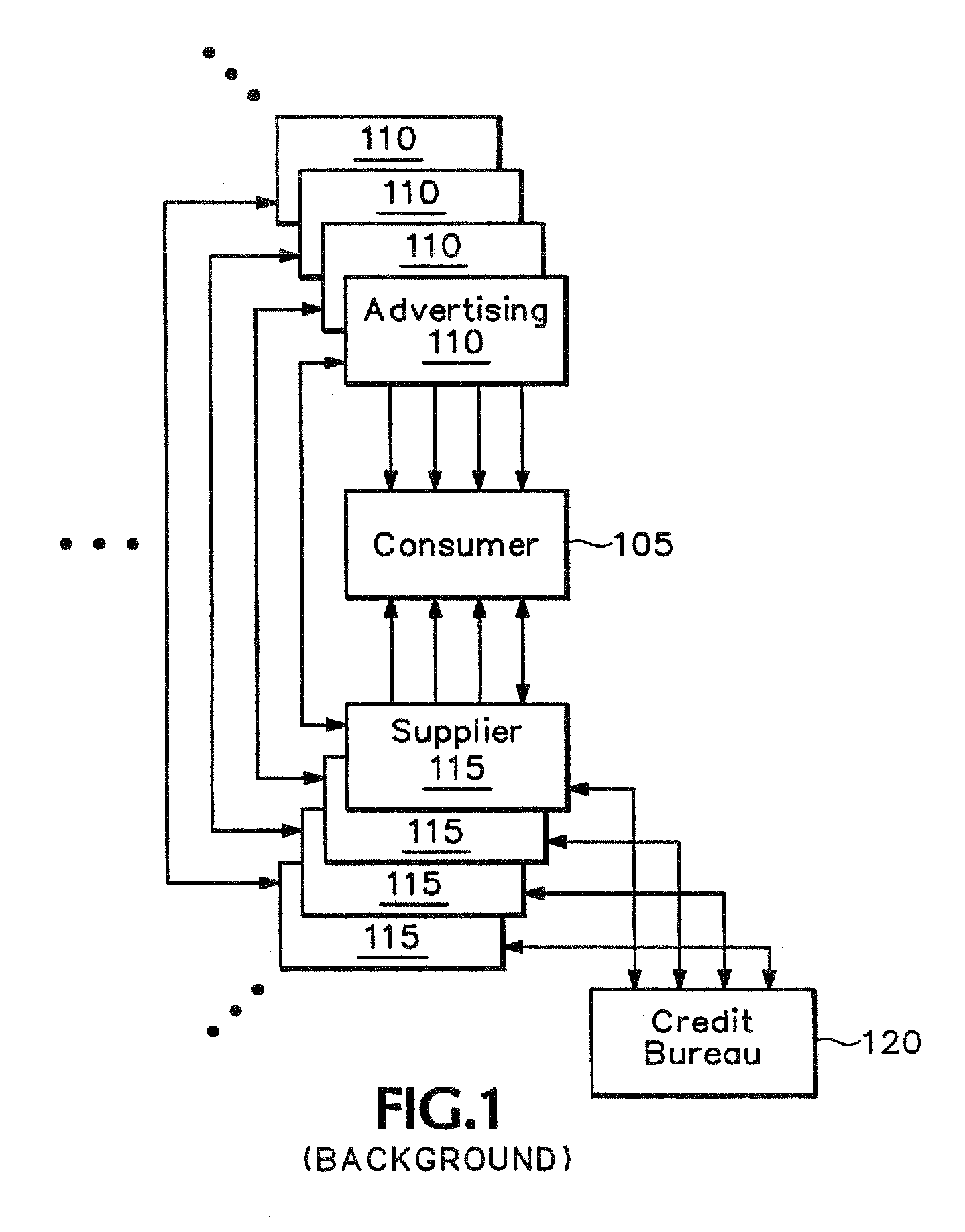

Marketing communication and transaction/distribution services platform for building and managing personalized customer relationships

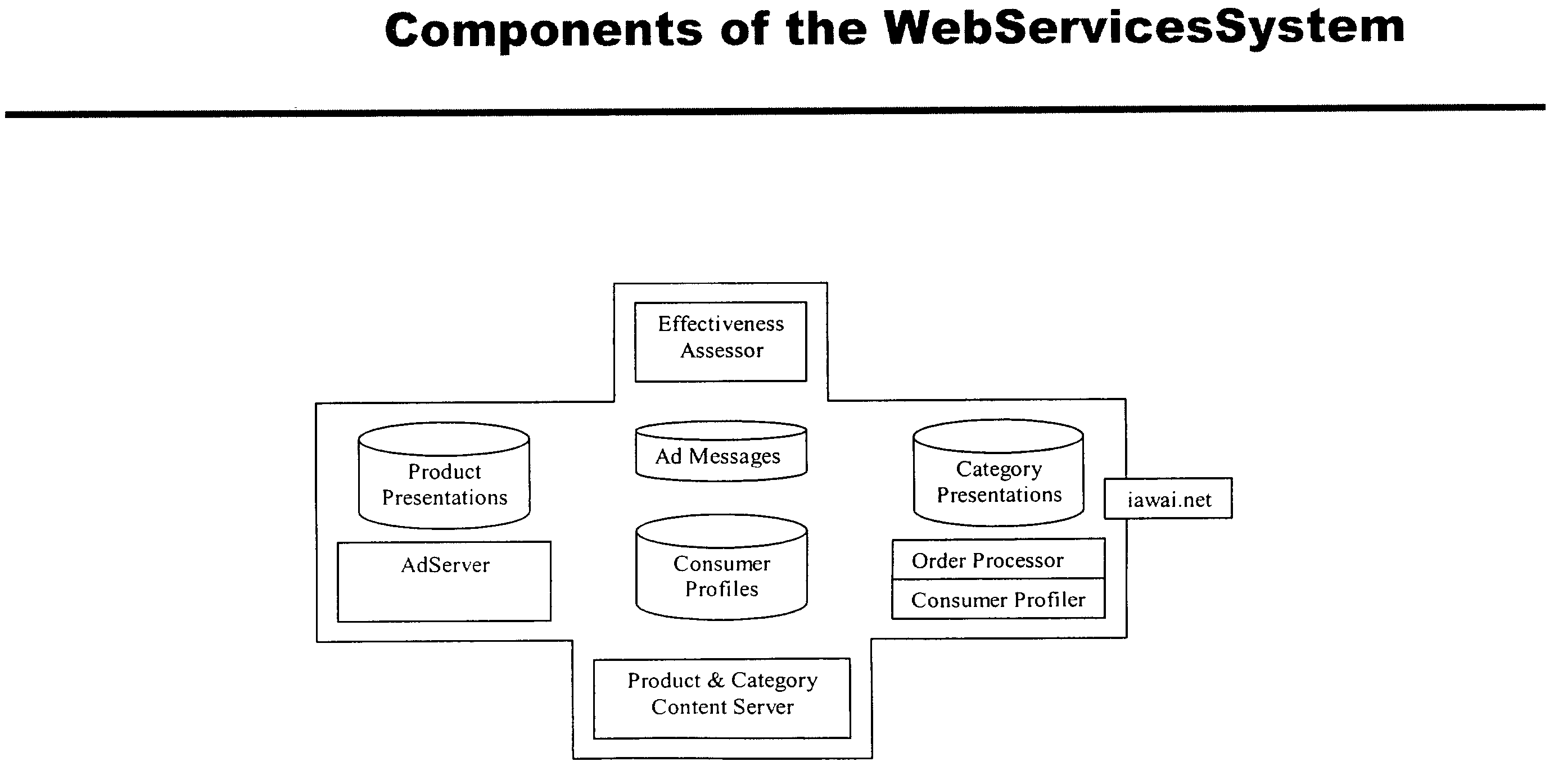

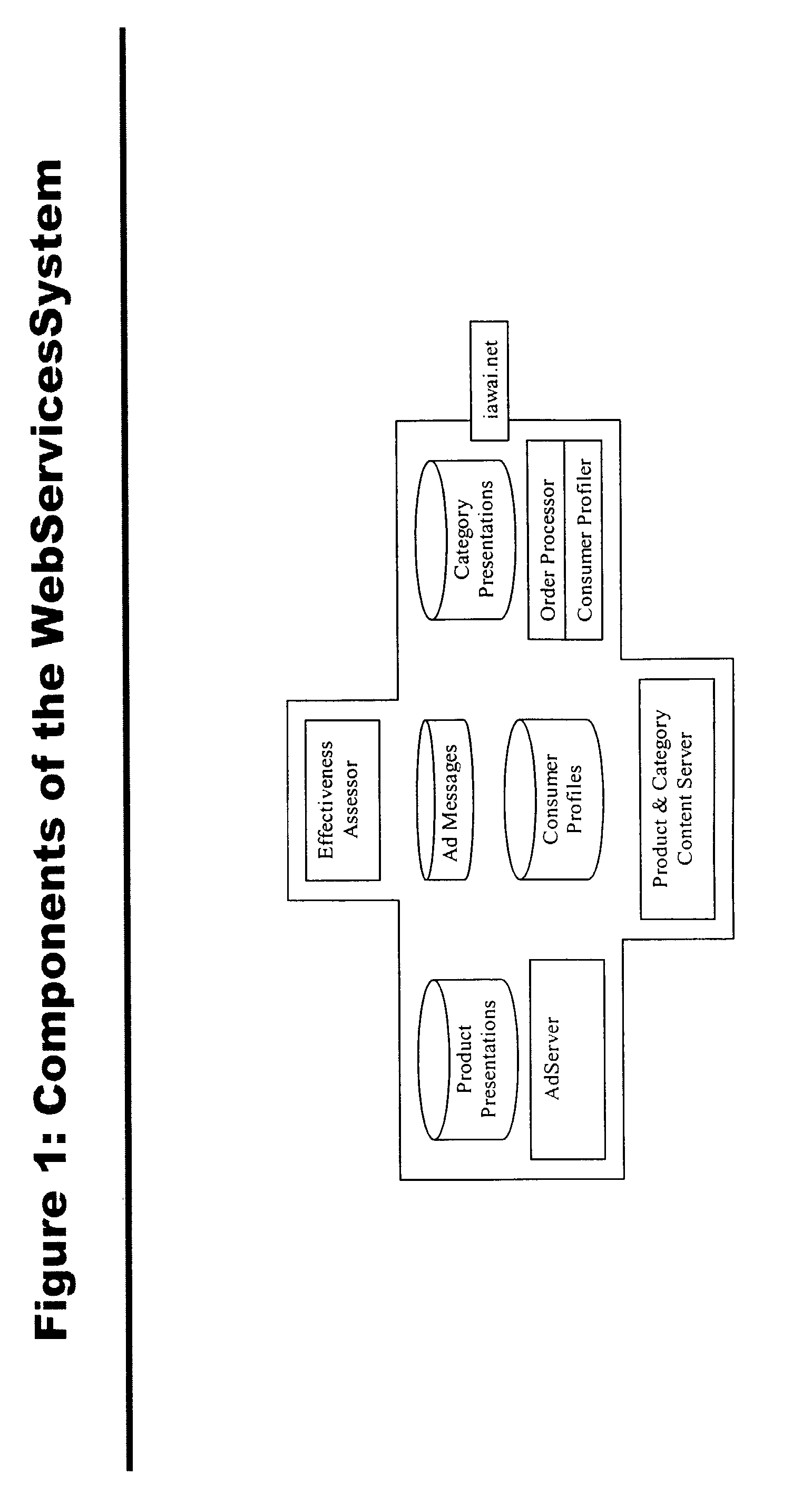

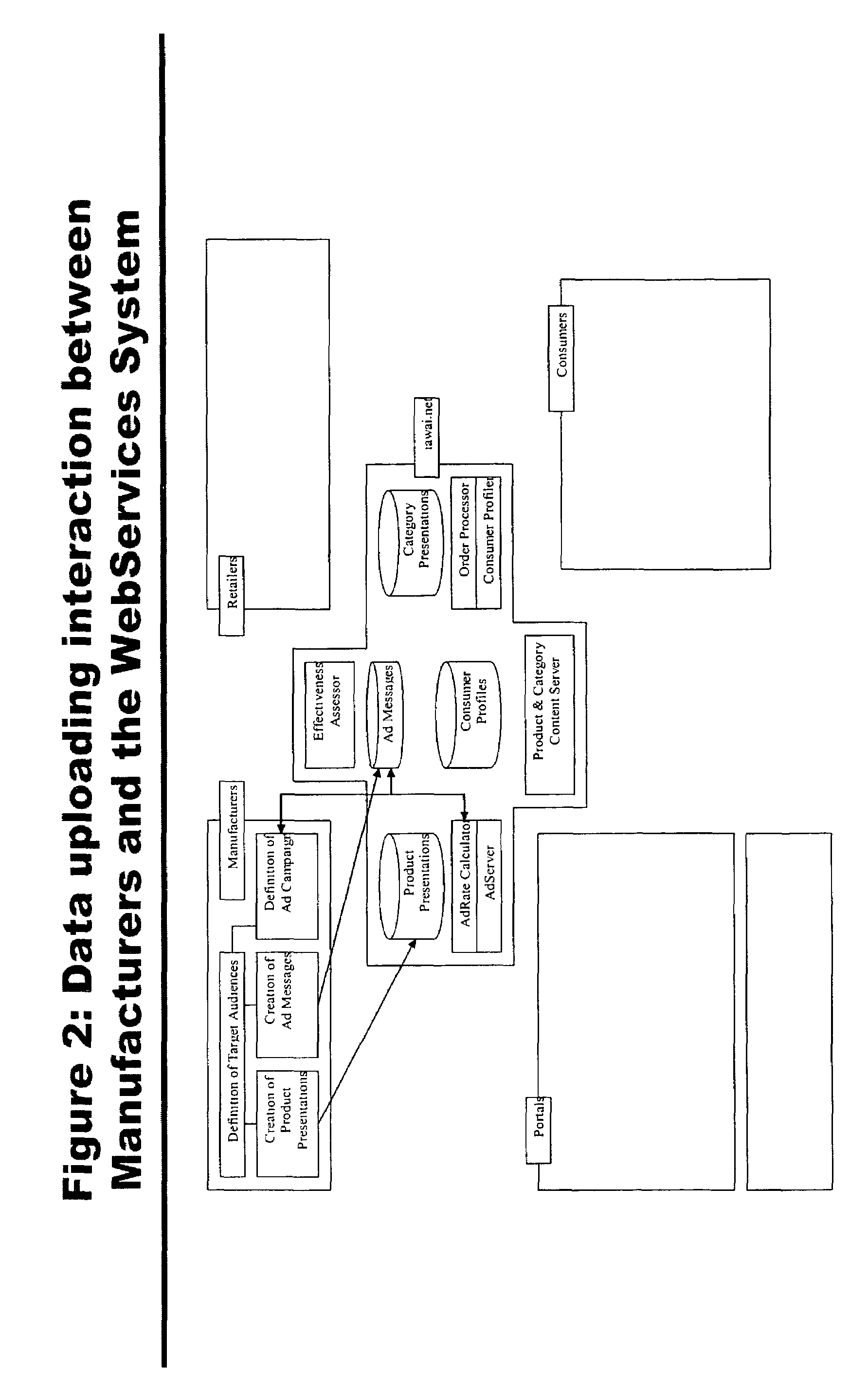

An interactive marketing communication and transaction services platform for managing personalized customer relationships. The platform facilitates communication and transactions between consumers, retailers and manufacturers, by helping suppliers customize product / service offerings, presentations and advertising messages to reflect individual consumers' needs, while providing portals with premium advertising messages for personal interactive info / news / entertainment services. The core of the platform consists of i) a central database system with ‘product / retail information’ and ‘holistic purchase-behavior specific consumer profiles’, generated by registering on-line product / retail information retrieved by consumers, as well as purchases made both on-line and in-store, using a loyalty card; ii) software applications, that create ‘market intelligence’ on manufacturer / retailer offers, consumer purchase needs, market performance of products / retailers and impact of brand / retailer presentations and ads on consumer purchase behavior; and iii) standard performance indicators, that make it possible to benchmark individual consumer communication programs against each other.

Owner:VAN DER RIET RAMON

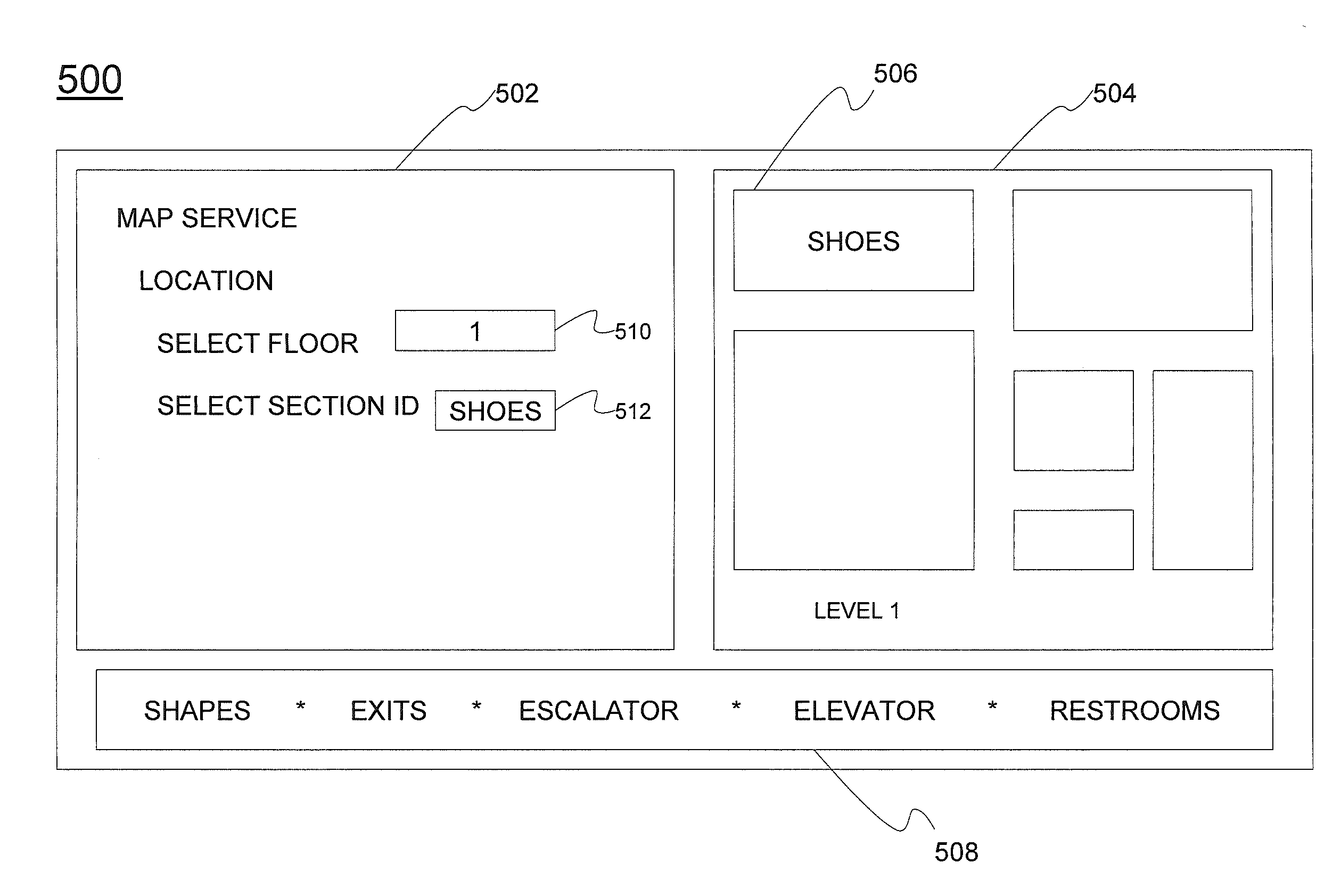

Automated transaction machine and method

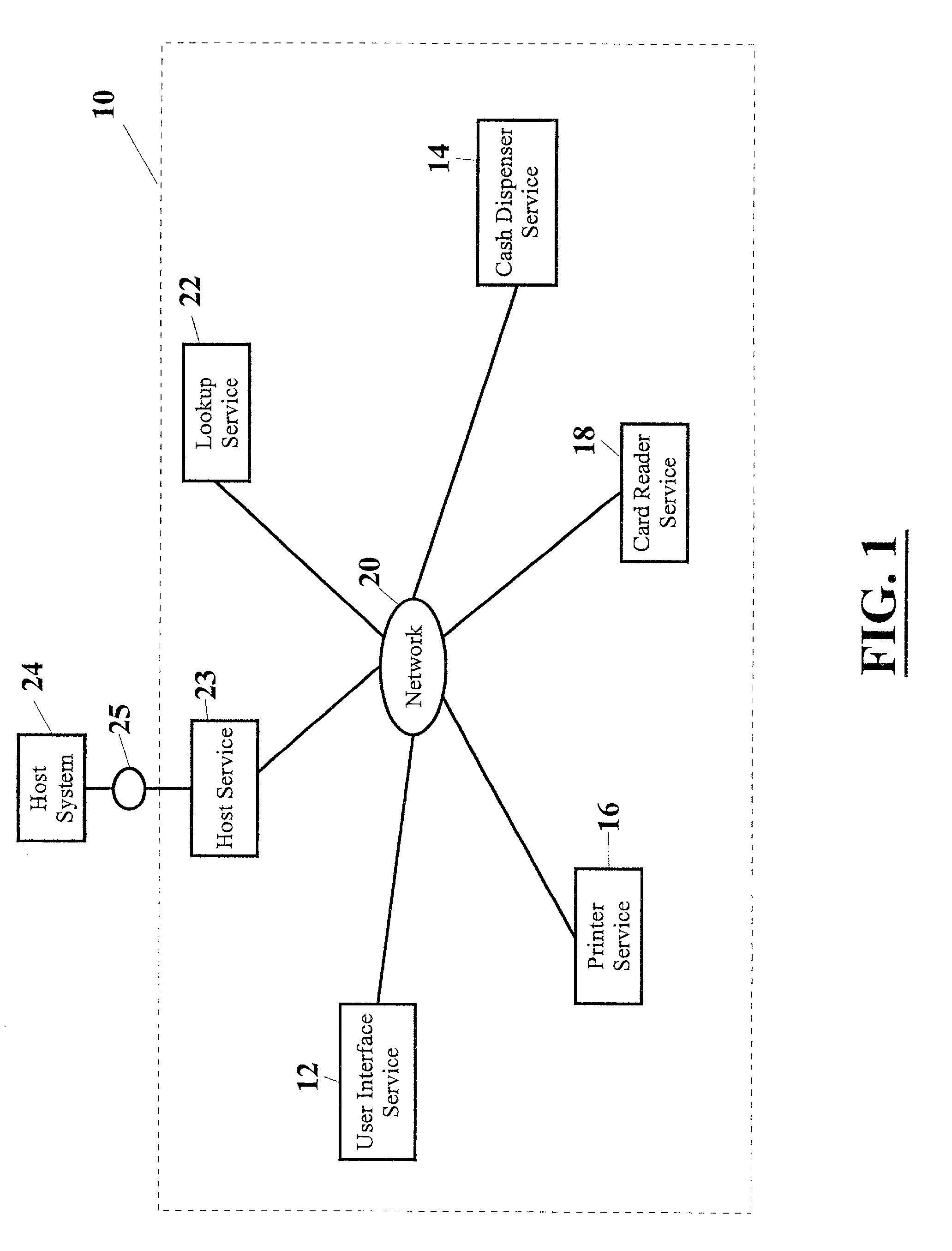

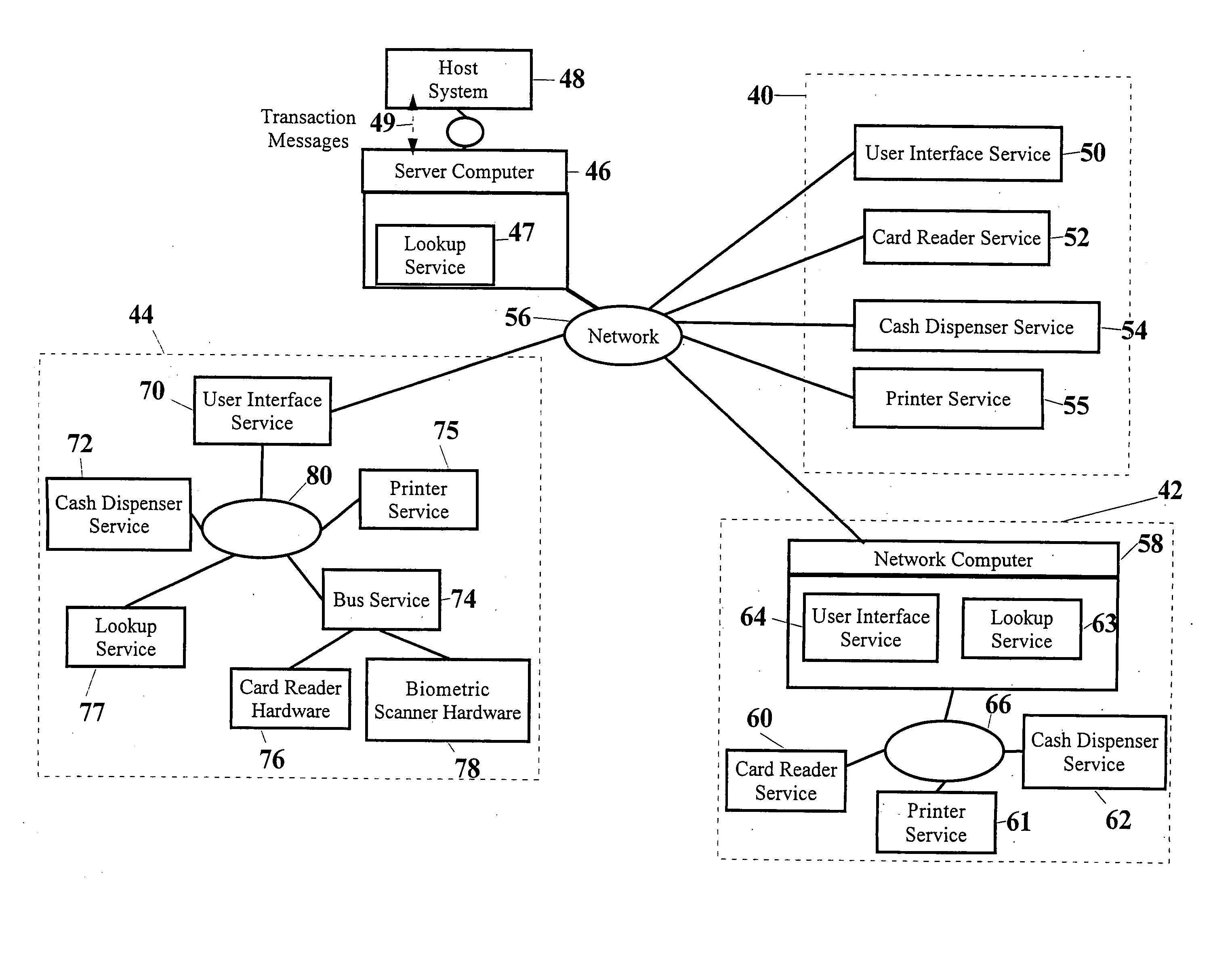

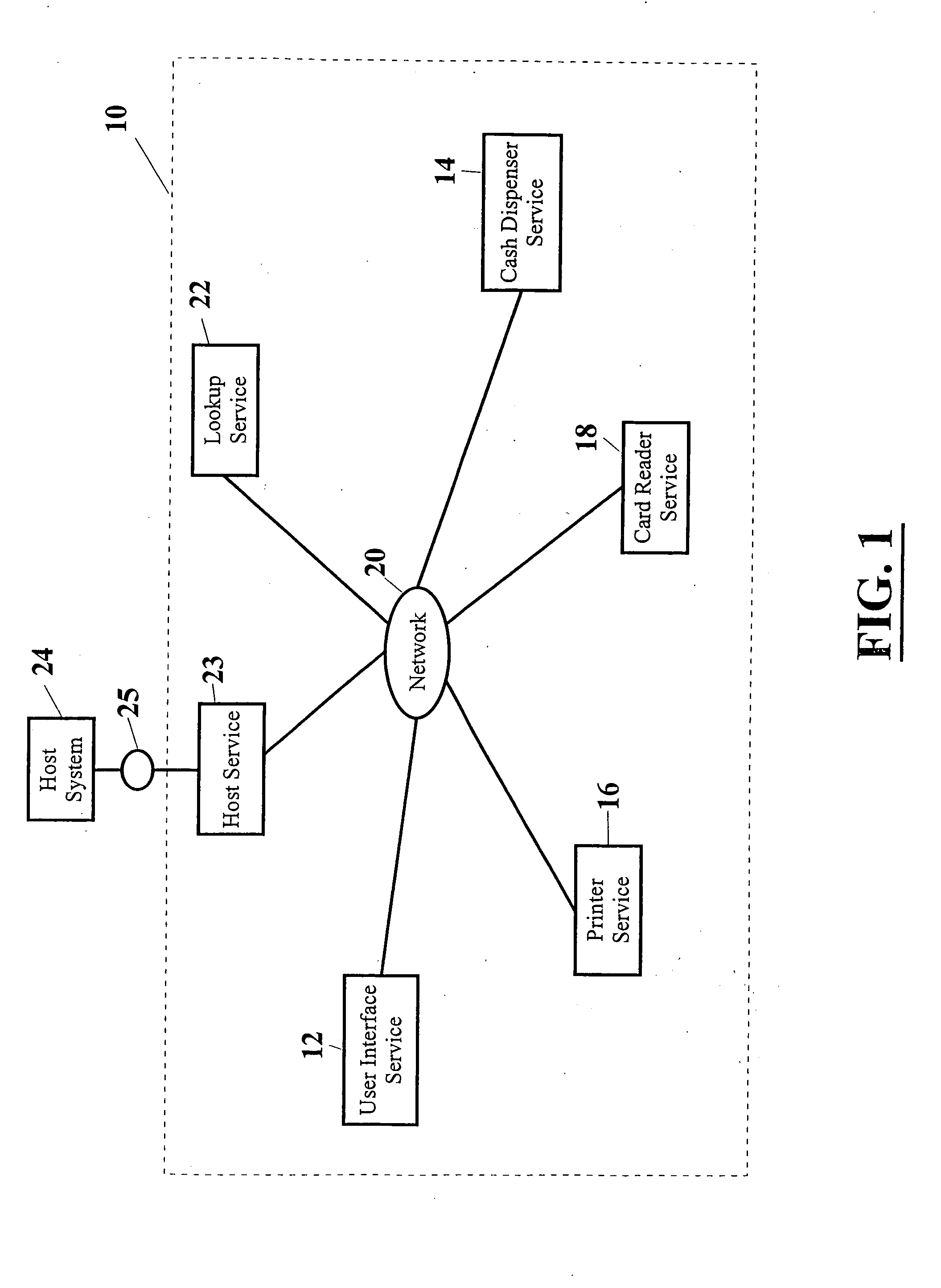

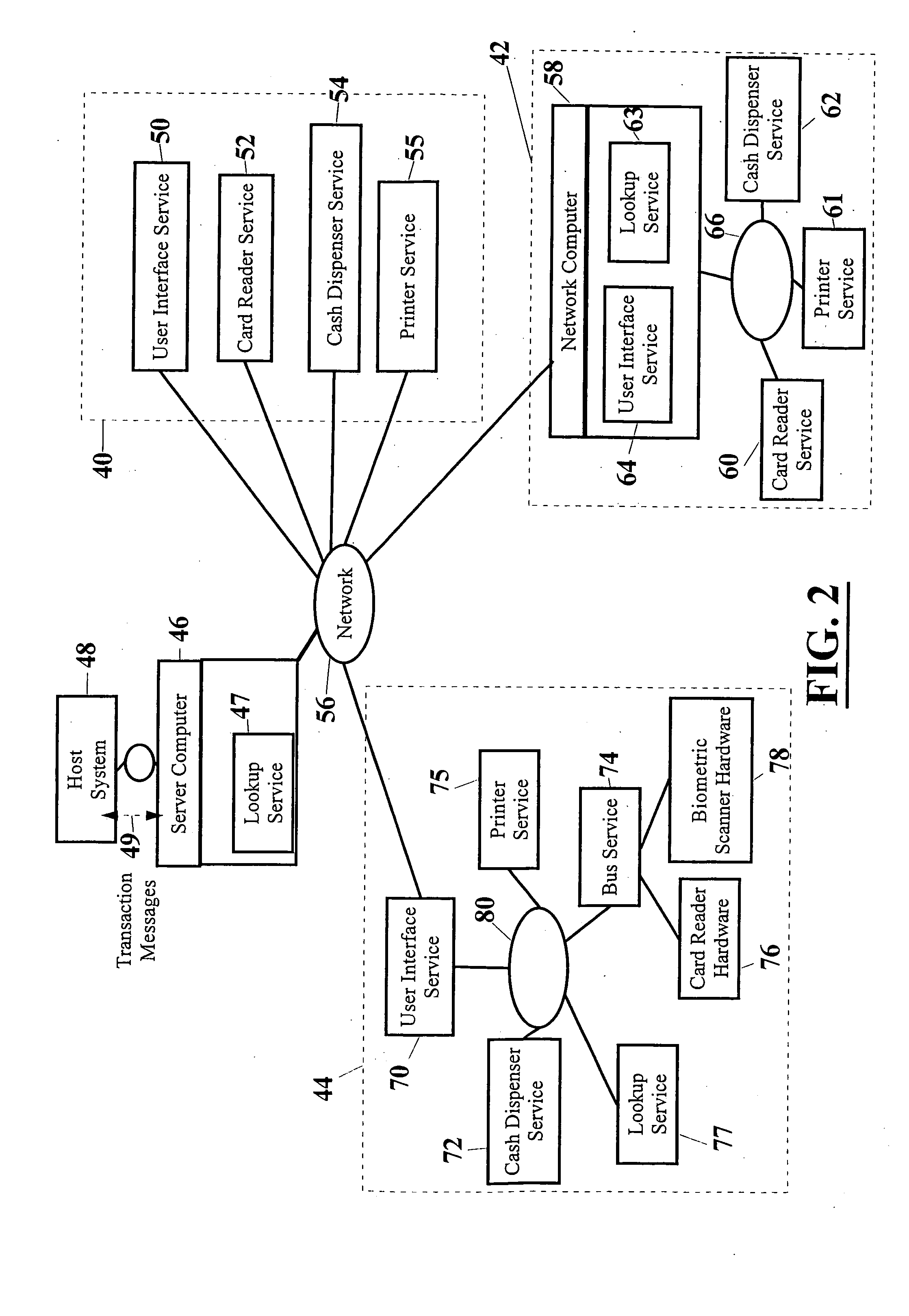

InactiveUS20010014881A1Firmly connectedExtension of timeComplete banking machinesFinanceTransaction serviceCard reader

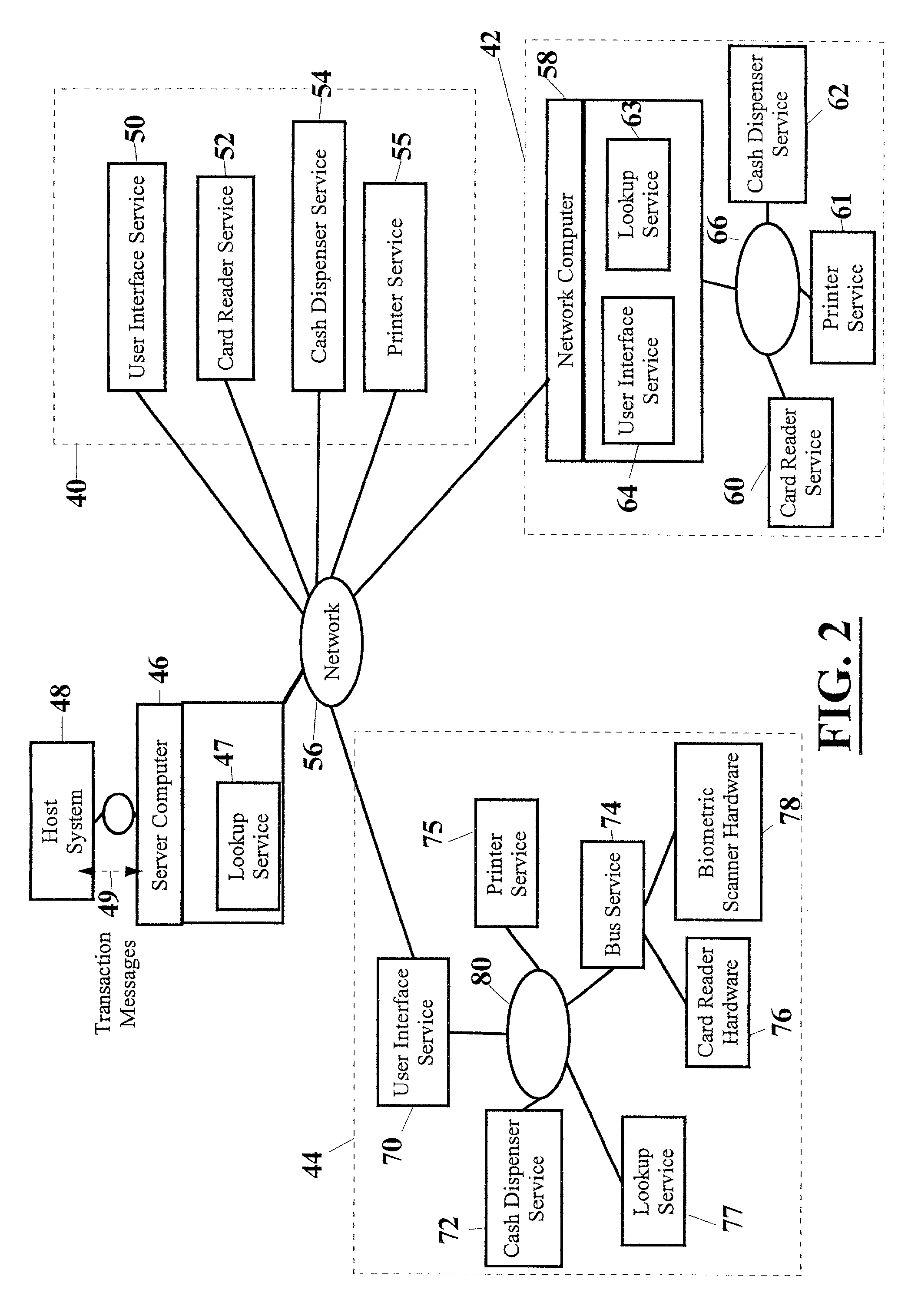

A system for connecting transaction services to an ATM (10, 500) that includes a network (20). A user interface service (12) and a lookup service (22) are in operative connection with the network. Transaction services such as a printer service (16), card reader service (18), and cash dispenser service (14) are also in operative connection with the network. These transaction services are operative to register with the lookup service and to upload a service proxy to the lookup service. The user interface service is operative to locate transaction services on the network by invoking a remote lookup method on the lookup service. The lookup service is operative to return service proxies that match the type of service that is required. The user interface service is further operative to invoke methods of the service proxies that remotely control the functionality of the transaction services on the network. The user interface service is further operative to register events with the service proxies for notification when certain events on the services occur.

Owner:DIEBOLD NIXDORF

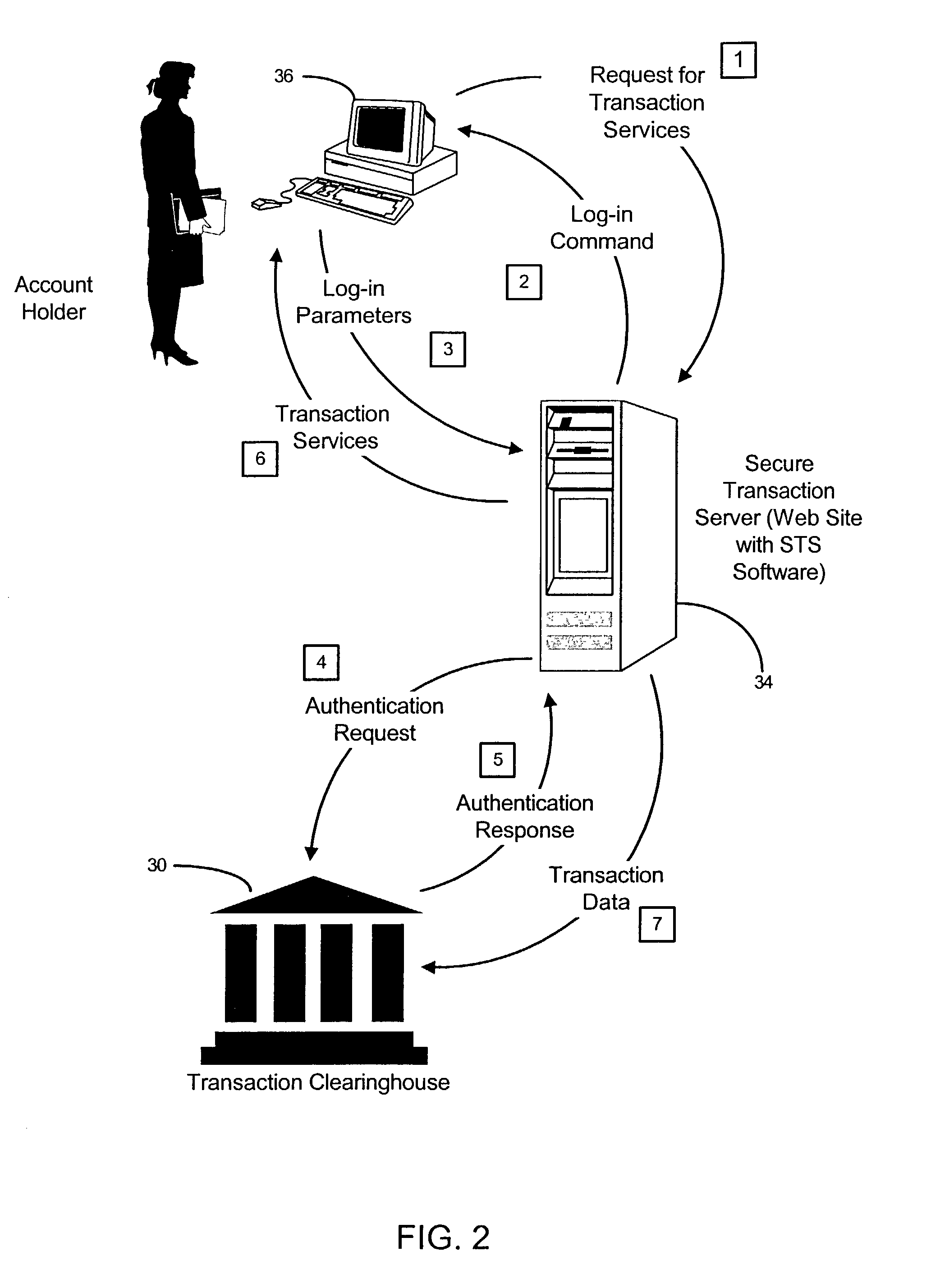

System and method for securing transactions and computer resources with an untrusted network

InactiveUS20030046589A1Digital data processing detailsCryptography processingComputer resourcesTransaction service

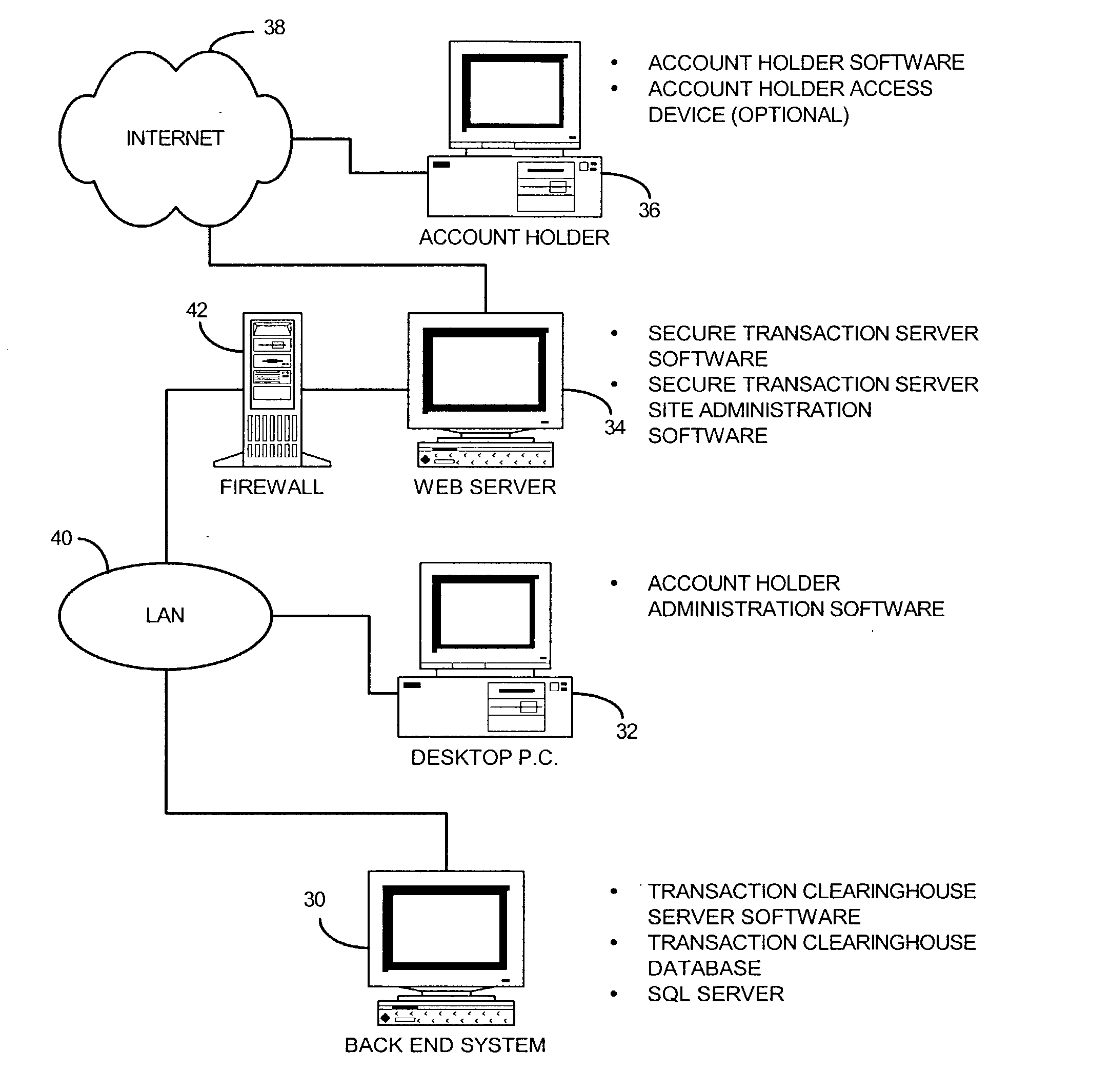

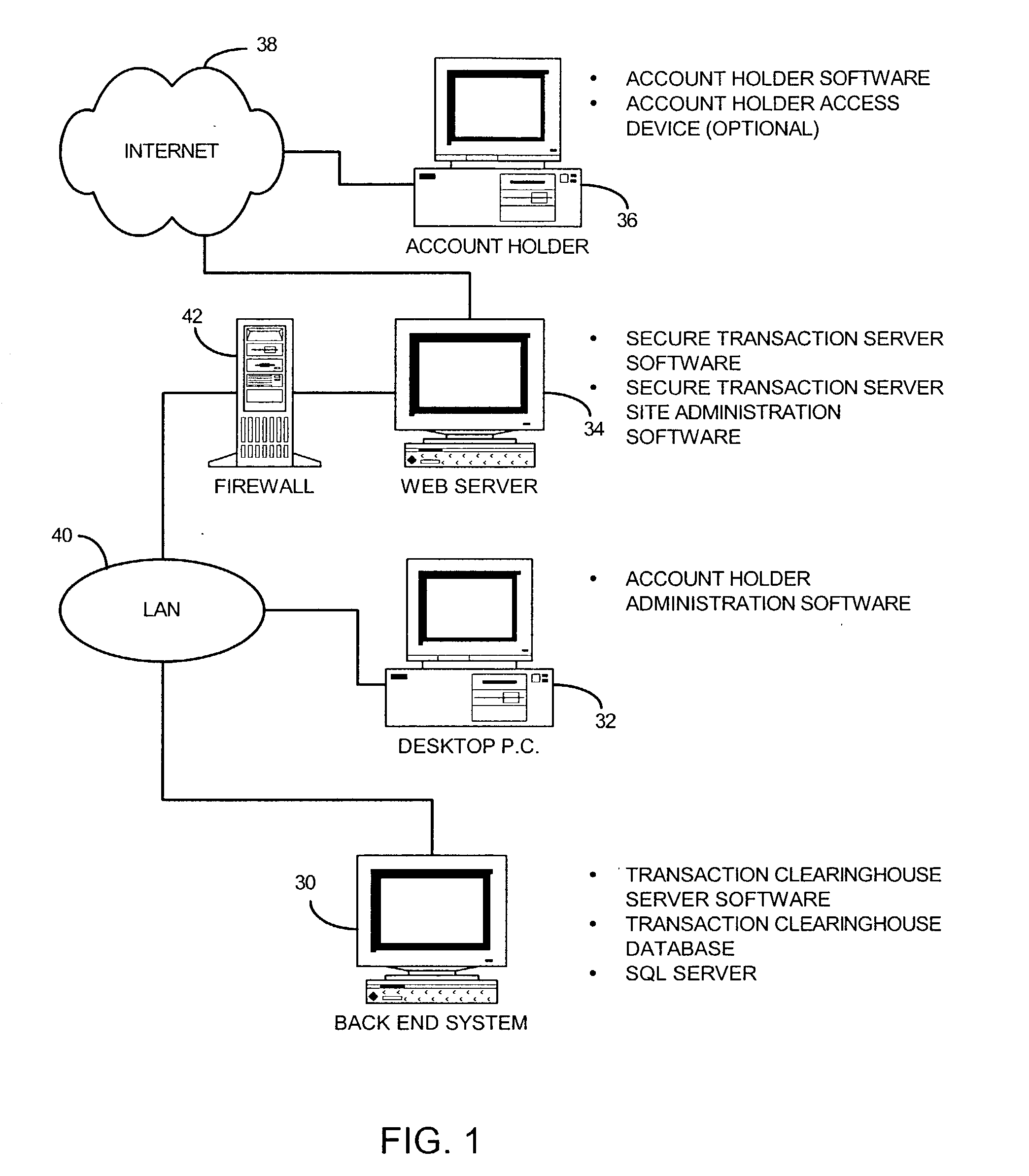

A system for securing and tracking usage of transaction services or computer resources by a client computer from a first server computer, which includes clearinghouse means for storing identity data of the first server computer and the client computer(s); server software means and client software means adapted to forward its identity data and identity data of the client computer(s) to the clearinghouse means at the beginning of an operating session; and a hardware key connected to the client computer, the key being adapted to generate a digital identification as part of the identity data; wherein the hardware key is implemented using a hardware token access system, a magnetic card access system, a smart card access system, a biometric identification access system or a central processing unit with a unique embedded digital identification.

Owner:PRISM TECH

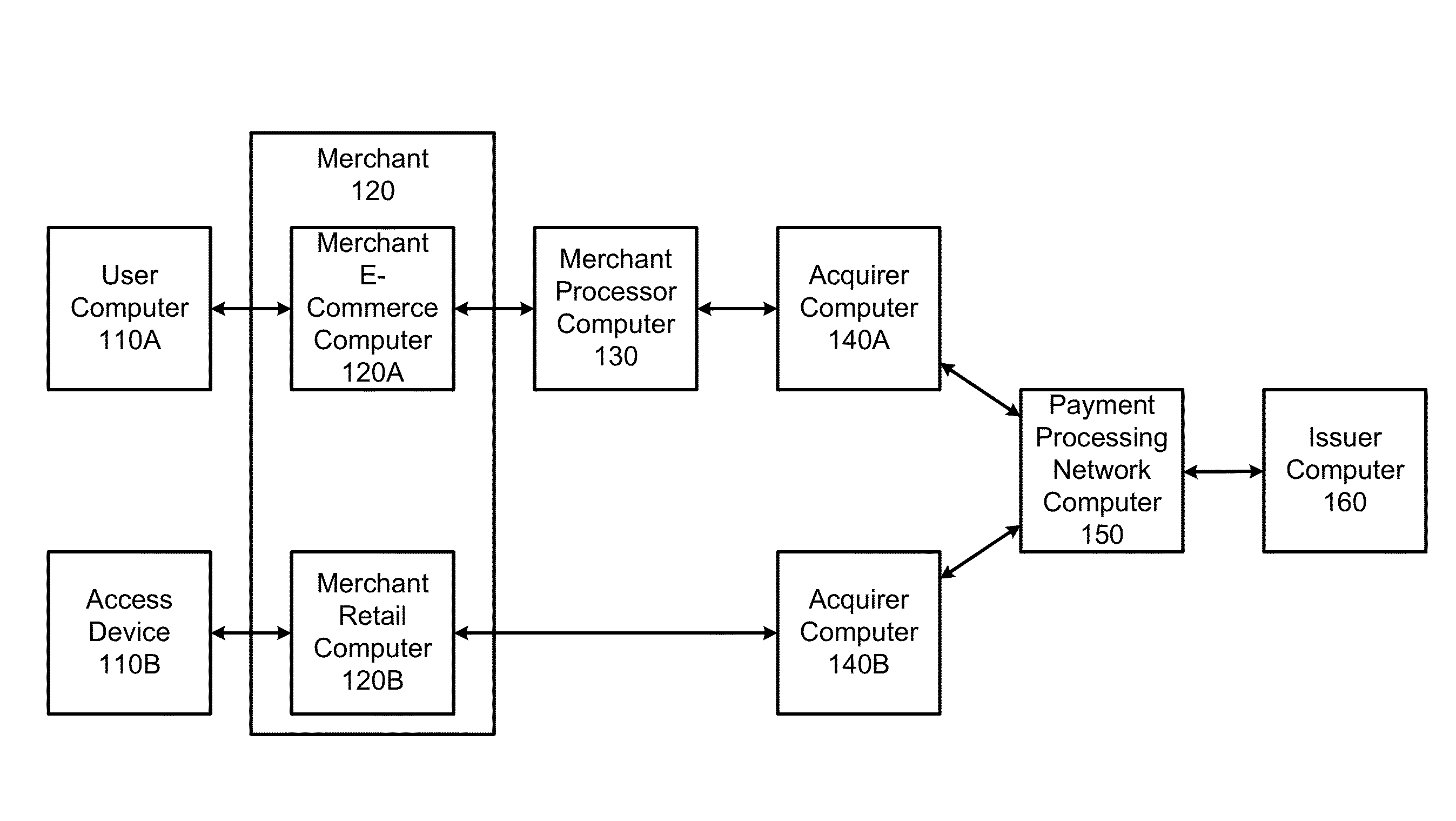

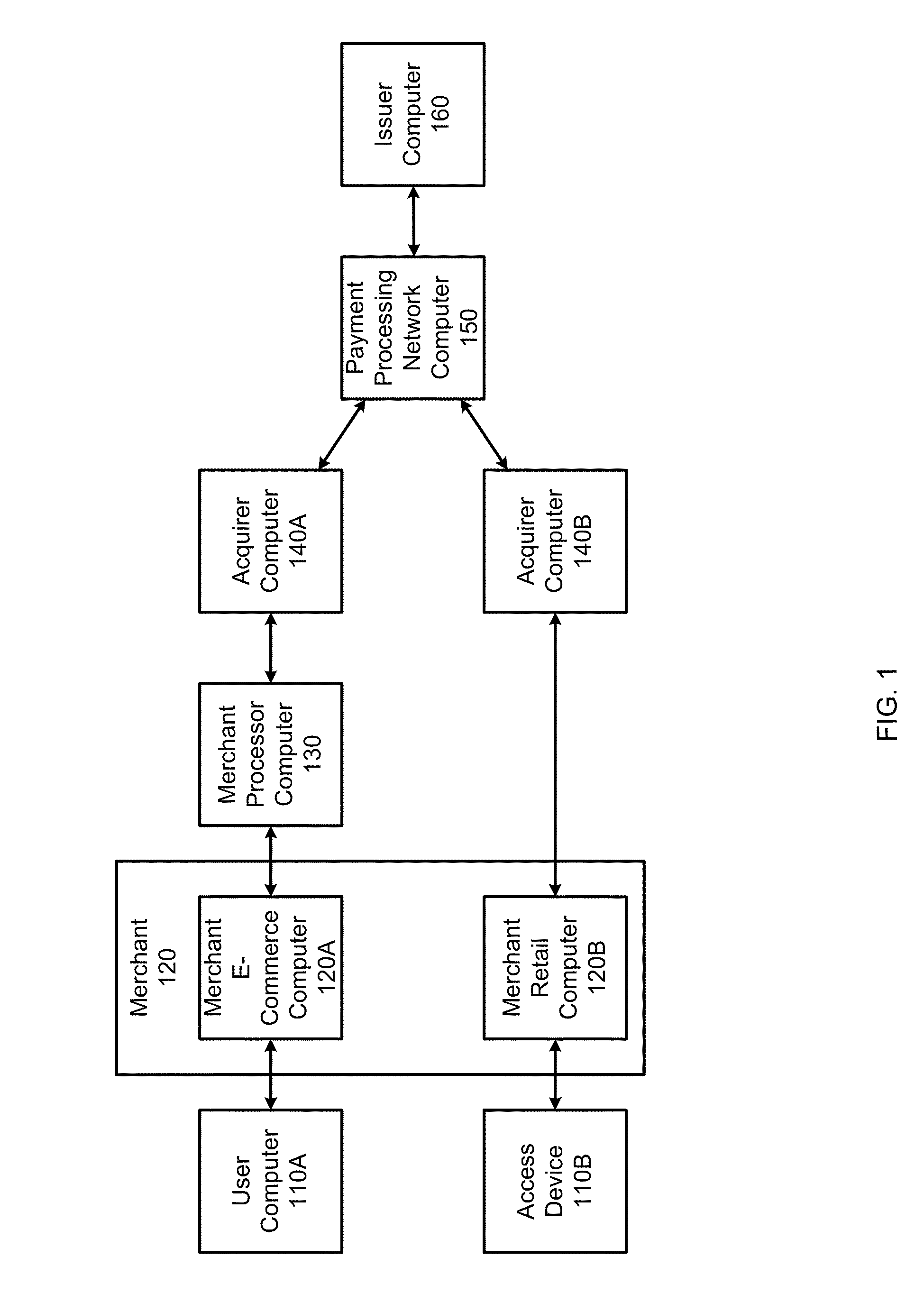

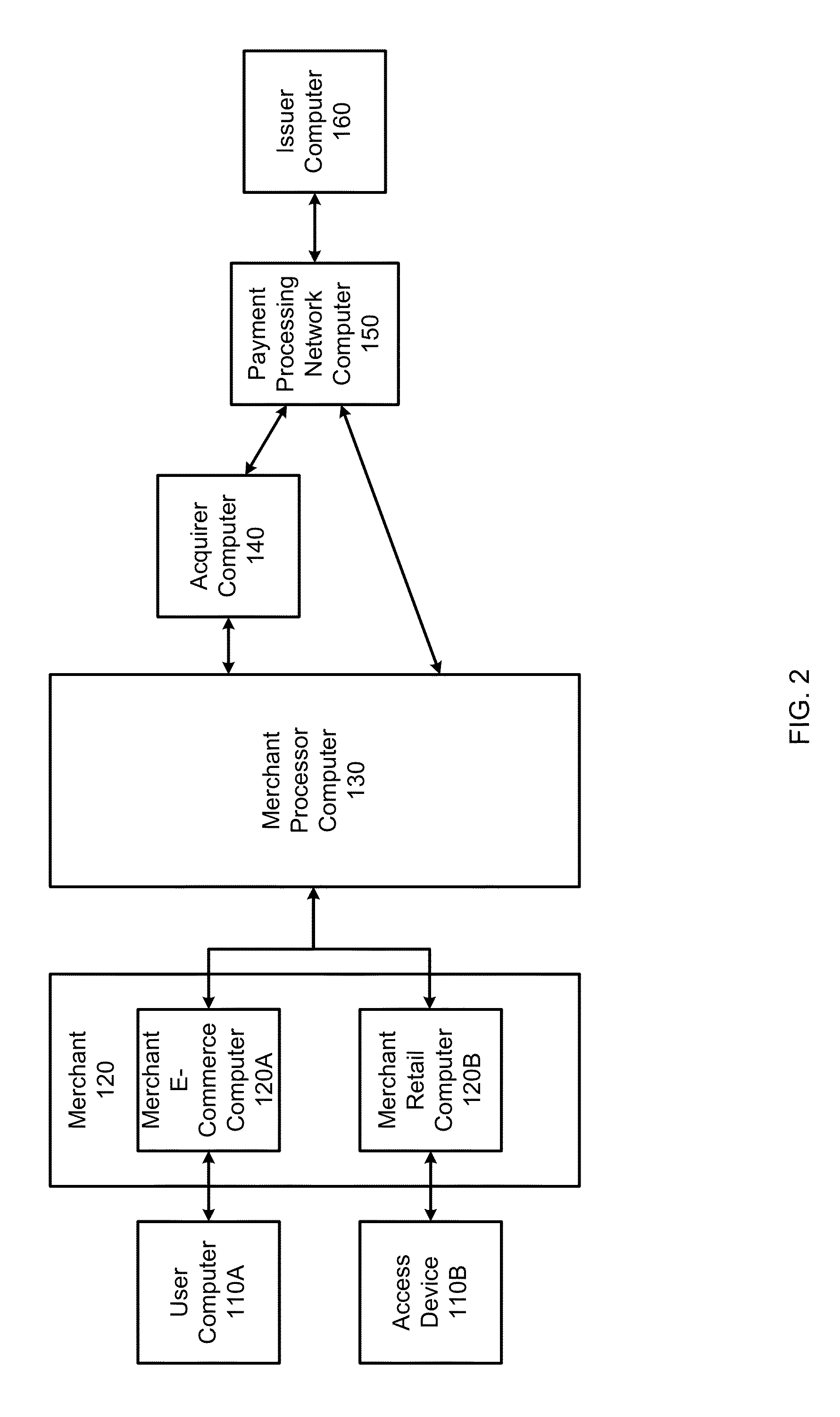

Embedded acceptance system

InactiveUS20140310183A1Reduce management costsImprove securityFinancePayment protocolsEnd-to-end encryptionPayment

Methods and systems can provide for unified processing of merchant transactions over various payment channels over which the transactions originate, such as in-person retail transactions and e-commerce transactions. For example, transactions can be received from payment channels through different payment channel-specific interfaces. The transactions from the various payment channels can then be sent to an entry point module that centrally manages the transactions. An orchestrator can then identify payment channel-agnostic transaction services to be applied to the transactions. This can allow for a unified end-to-end encryption implementation across a merchant's enterprise, reducing management costs and improving overall security. Similarly, universal tokenization services, payment and fraud management can be provided across a merchant's entire enterprise.

Owner:VISA INT SERVICE ASSOC

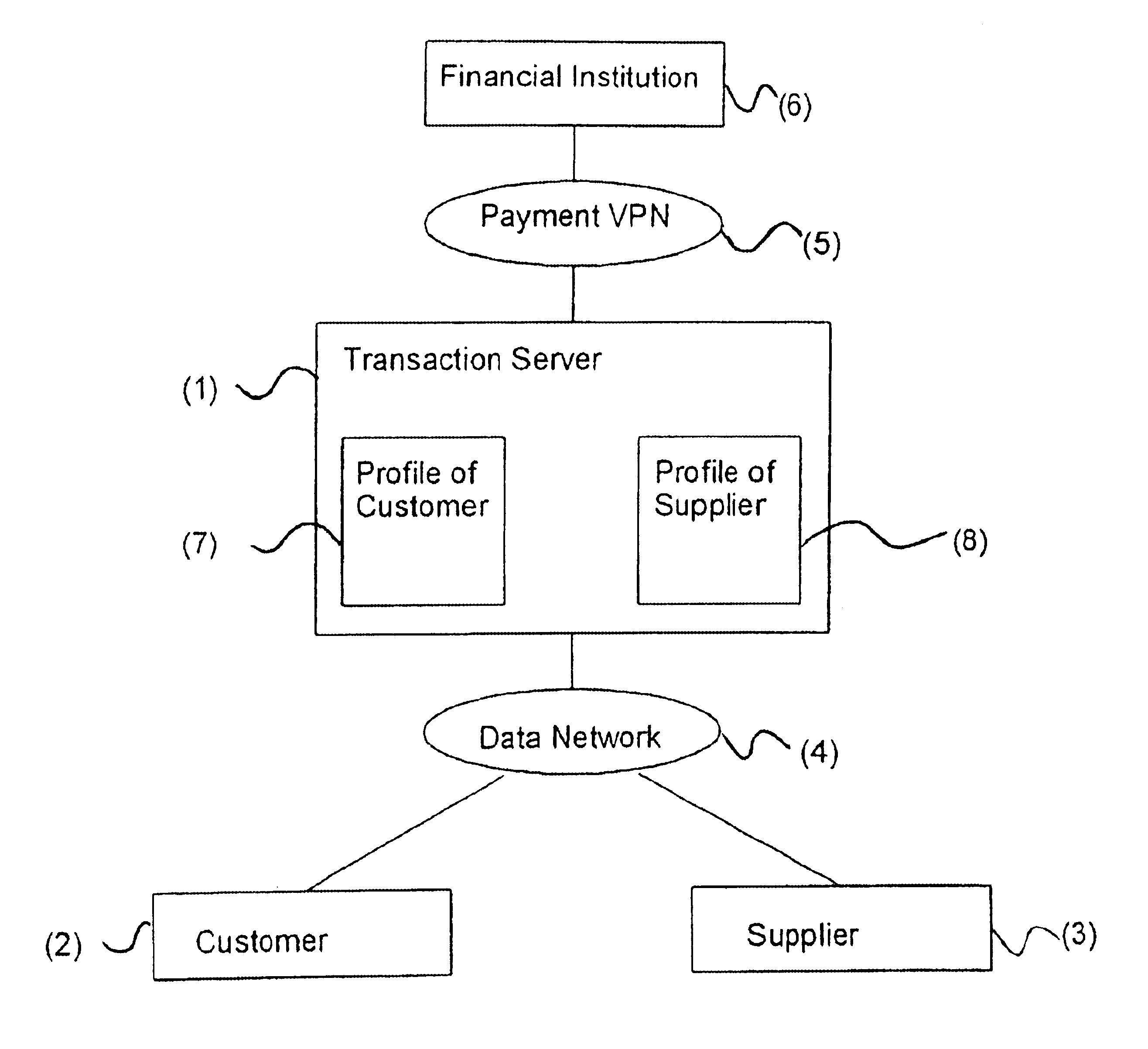

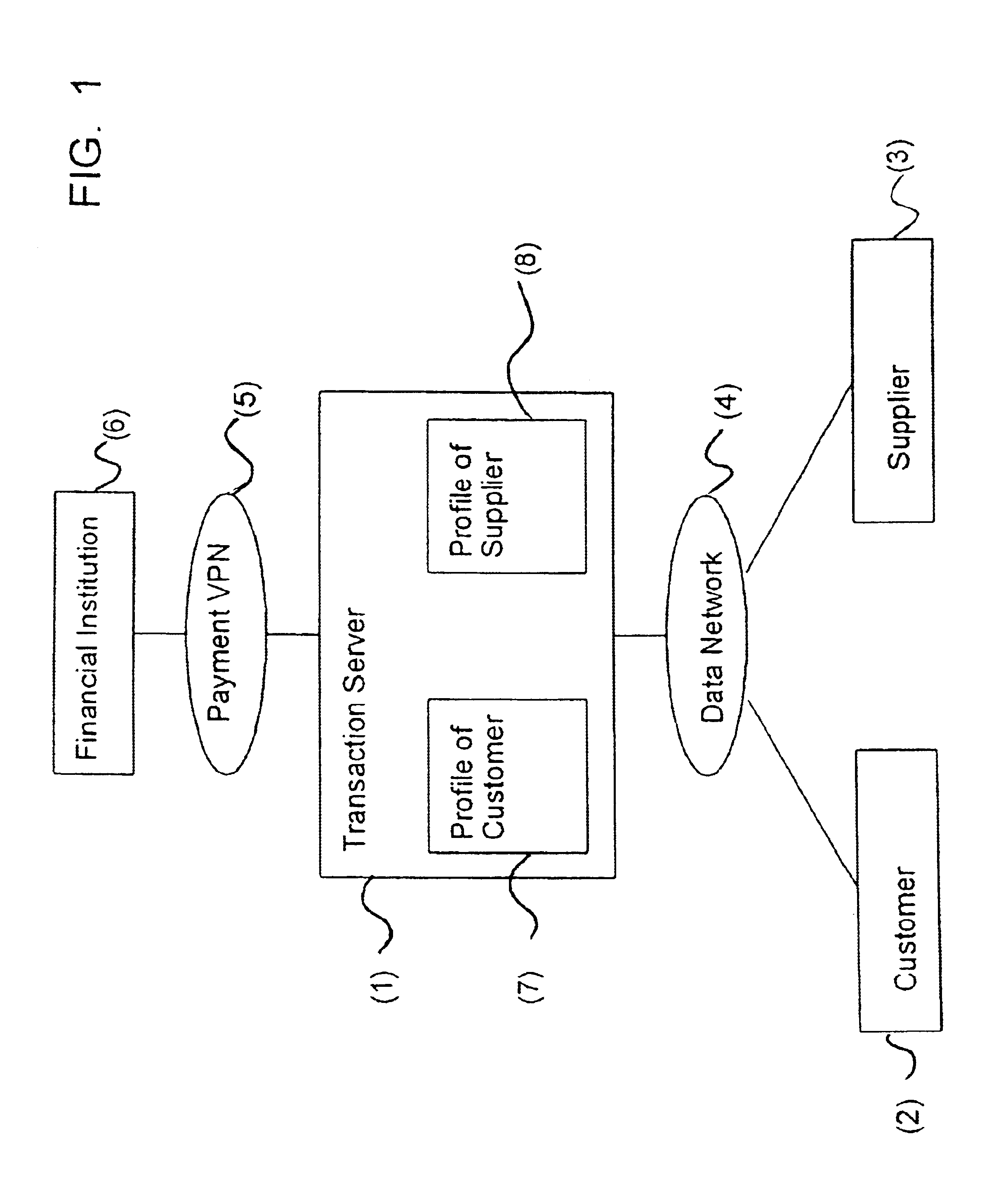

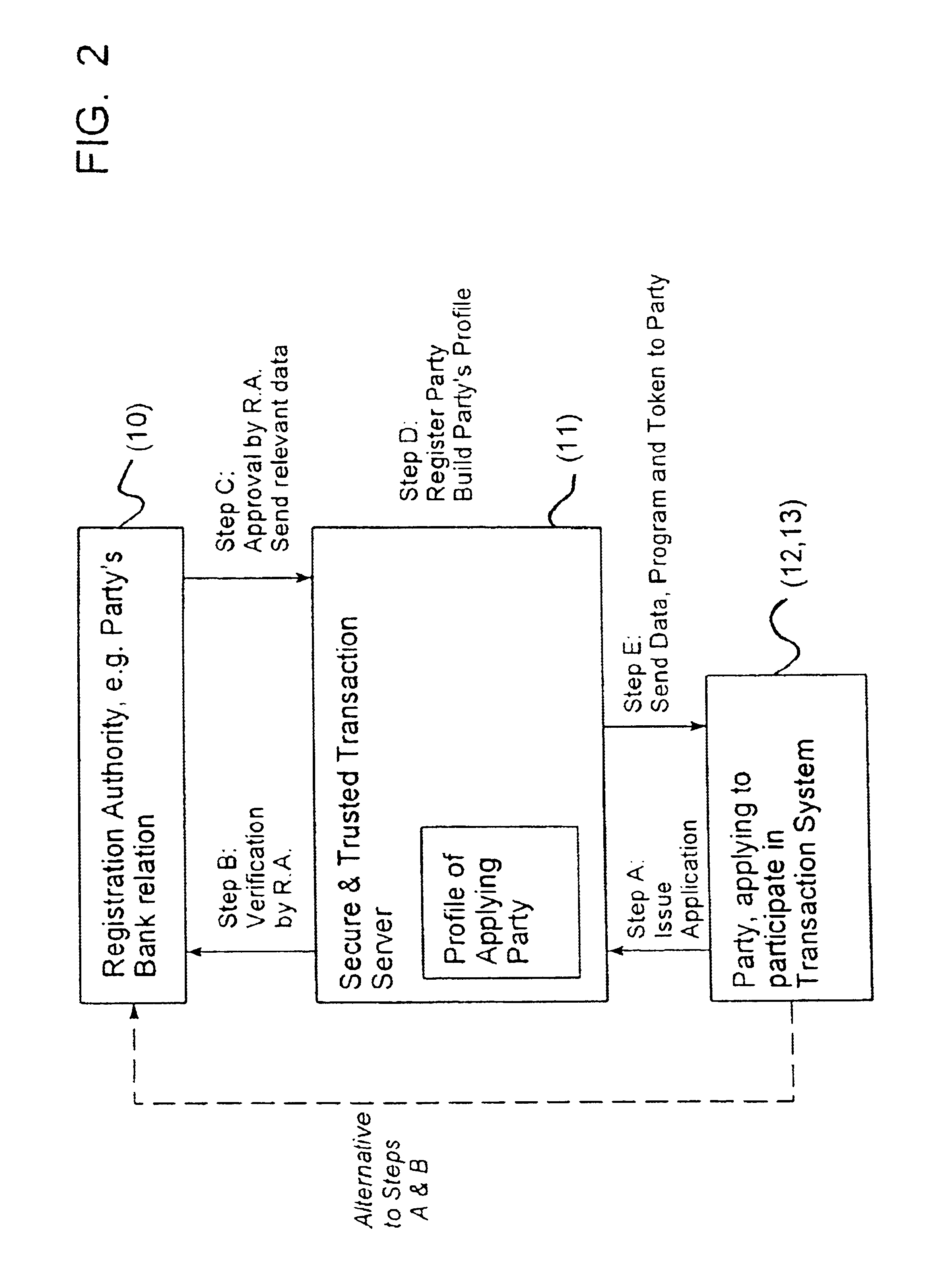

Transaction method and system for data networks, like internet

InactiveUS6889325B1Easy to implementEliminate needUser identity/authority verificationMultiple digital computer combinationsTransaction serviceDigital signature

A method and a system for performing a transaction between at least one first party and at least one second party are disclosed. A data network connects data input / output terminals of the parties. In the data network, a secure and trusted transaction server is provided, in which a profile of the parties is registered, having a party identifier identifying a particular party, and authentication data for authenticating the party and data sent by the party. The parties communicate with each other through the transaction server by means of various transaction messages, which are digitally signed using a table of random numbers and a hashing operation, wherein the table of random numbers is generated by reading a token.

Owner:UNICATE

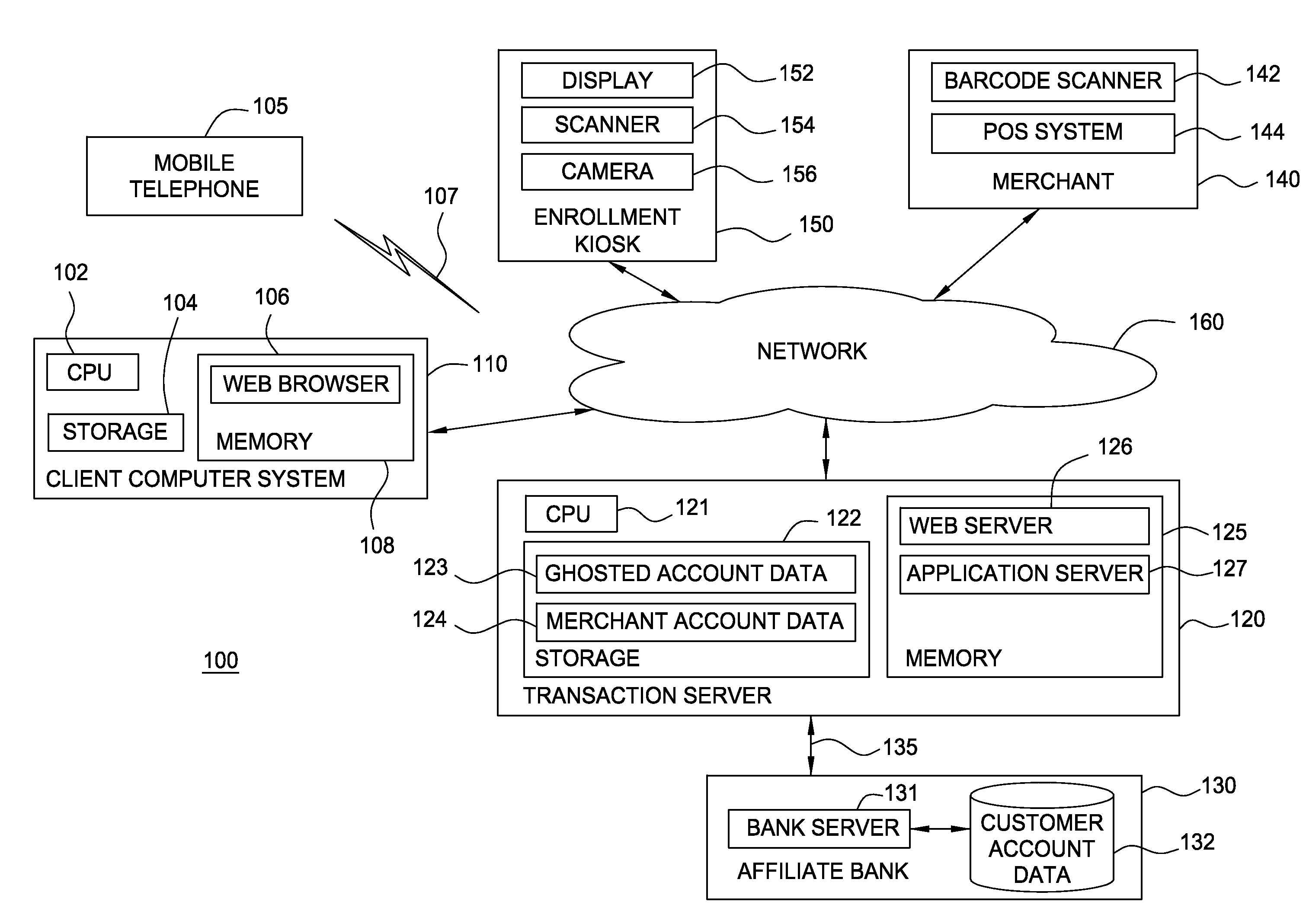

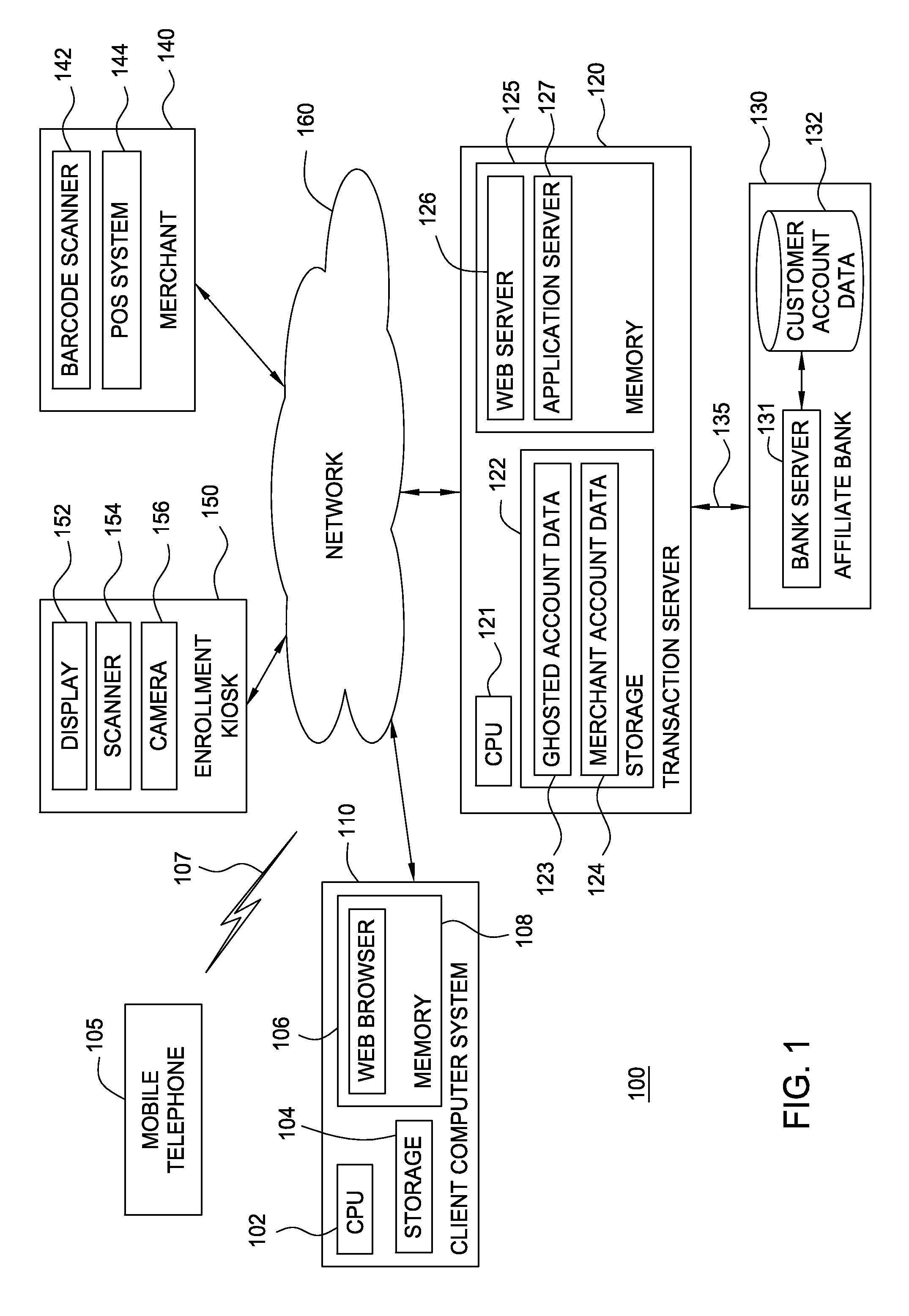

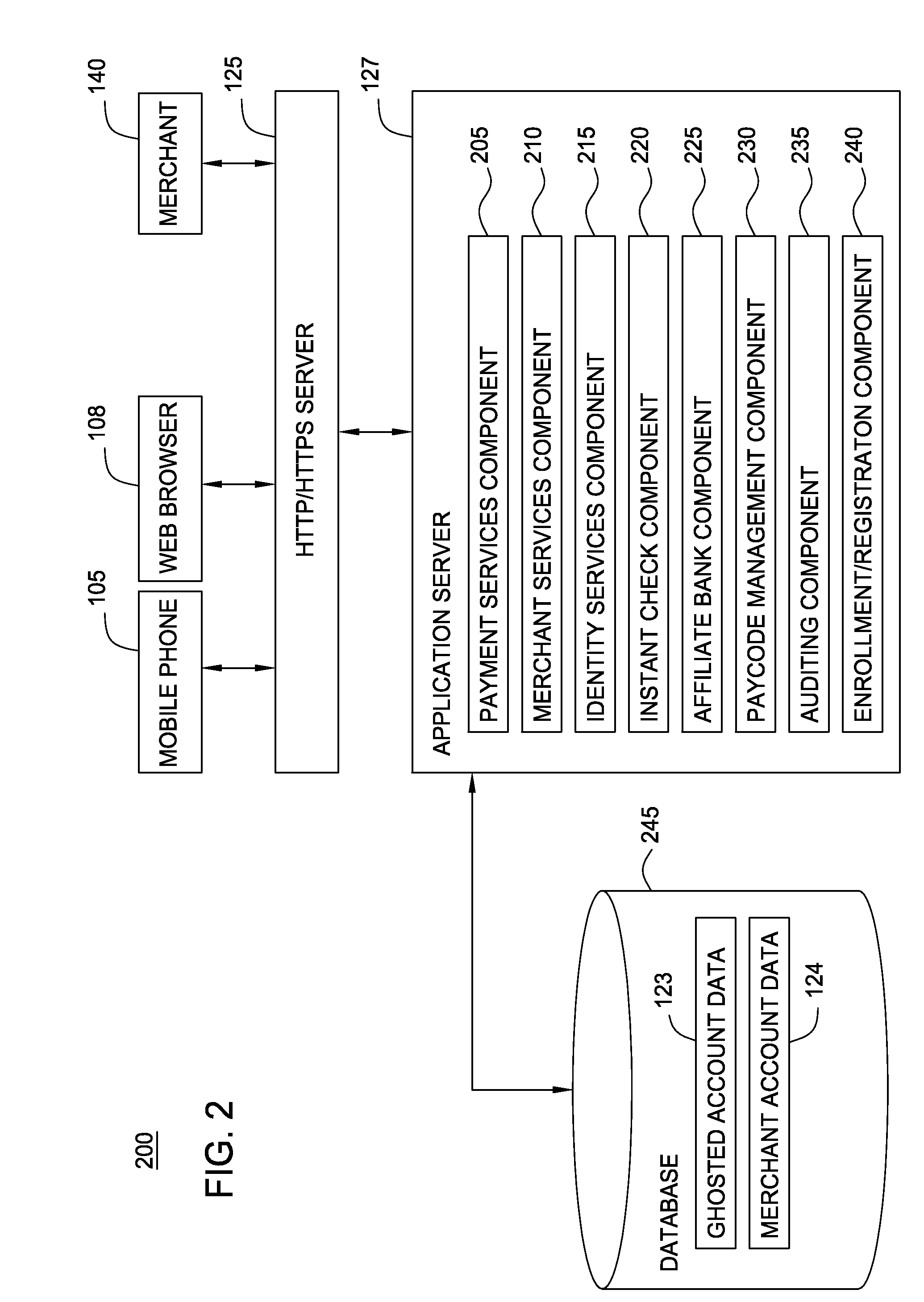

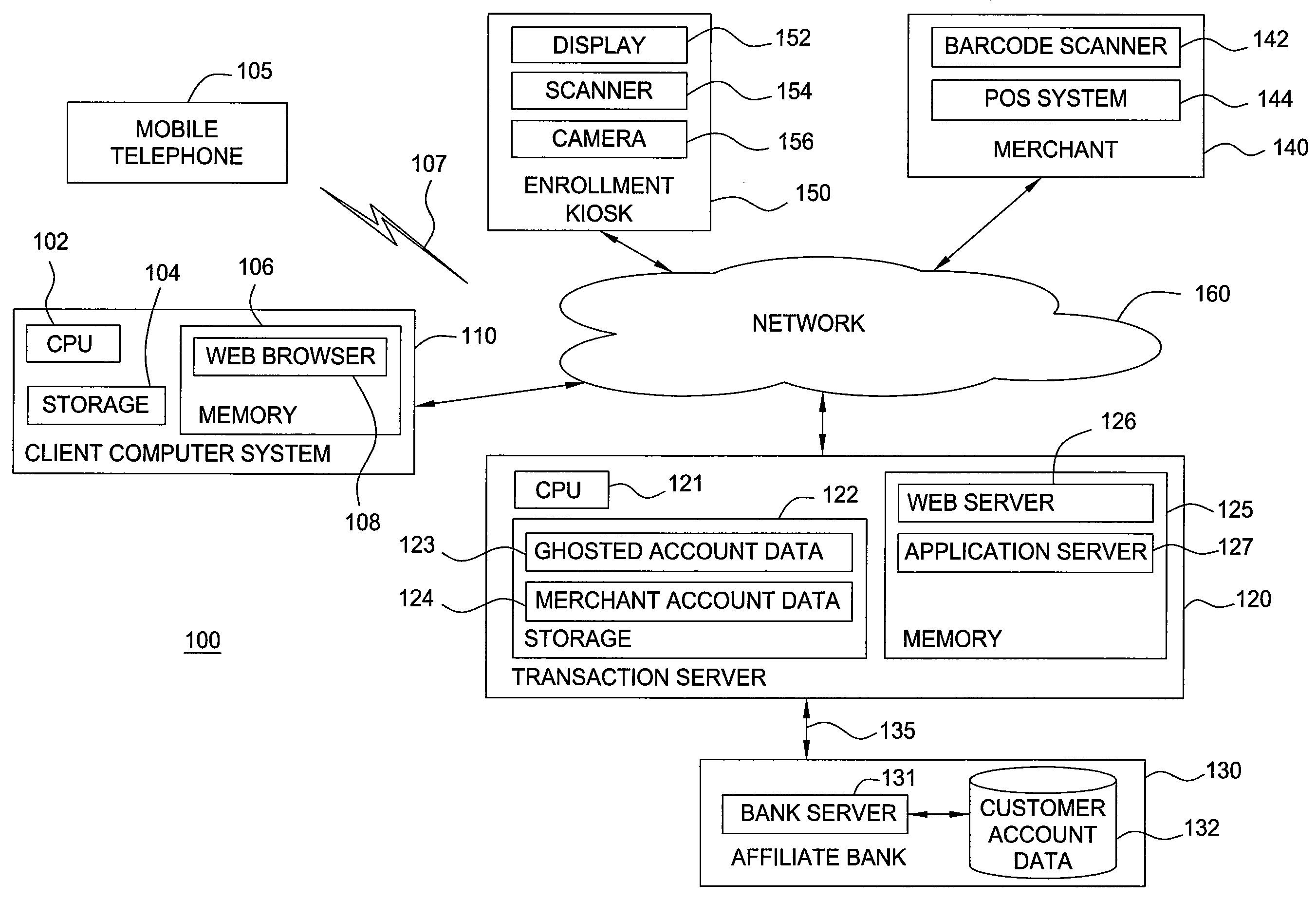

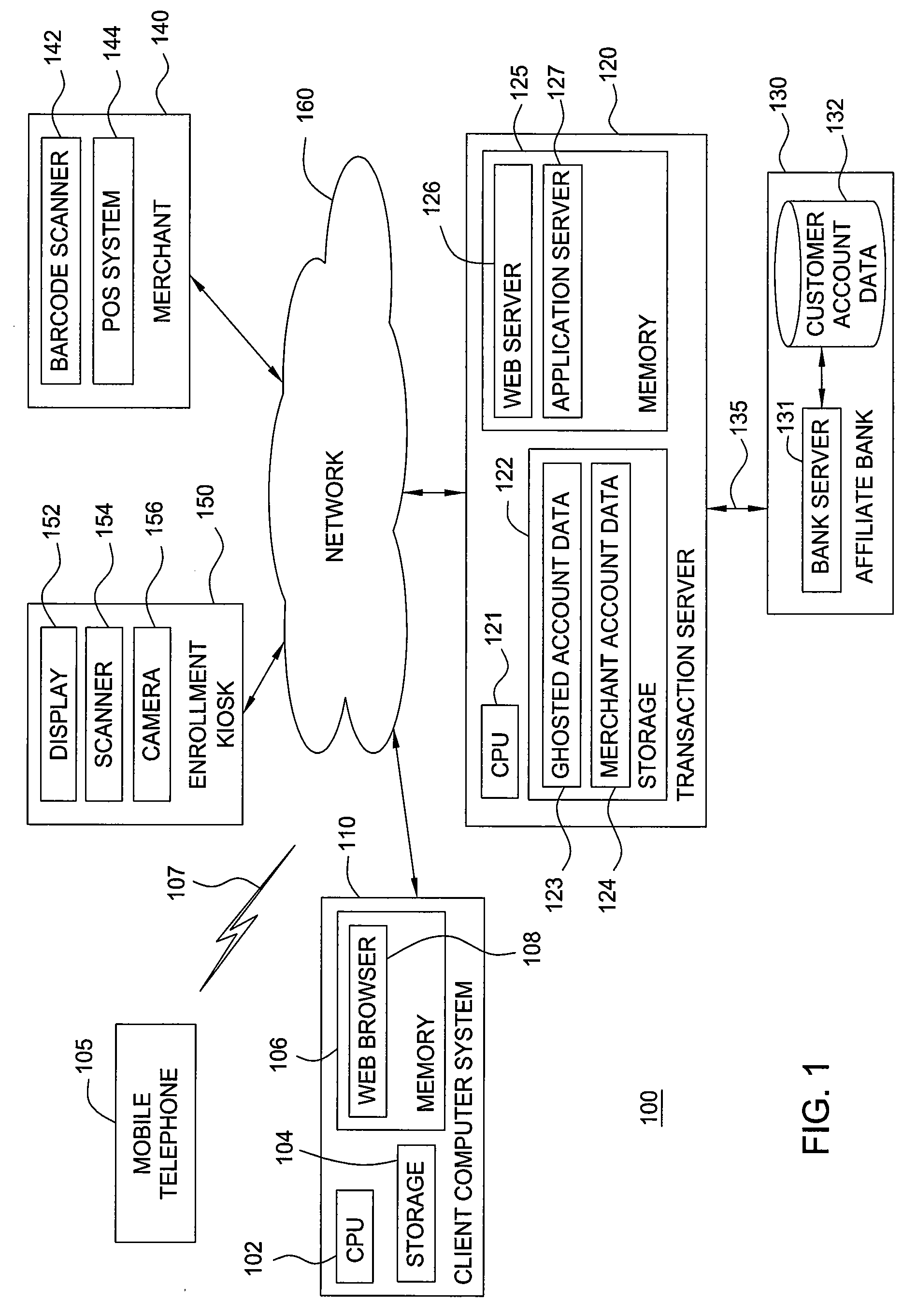

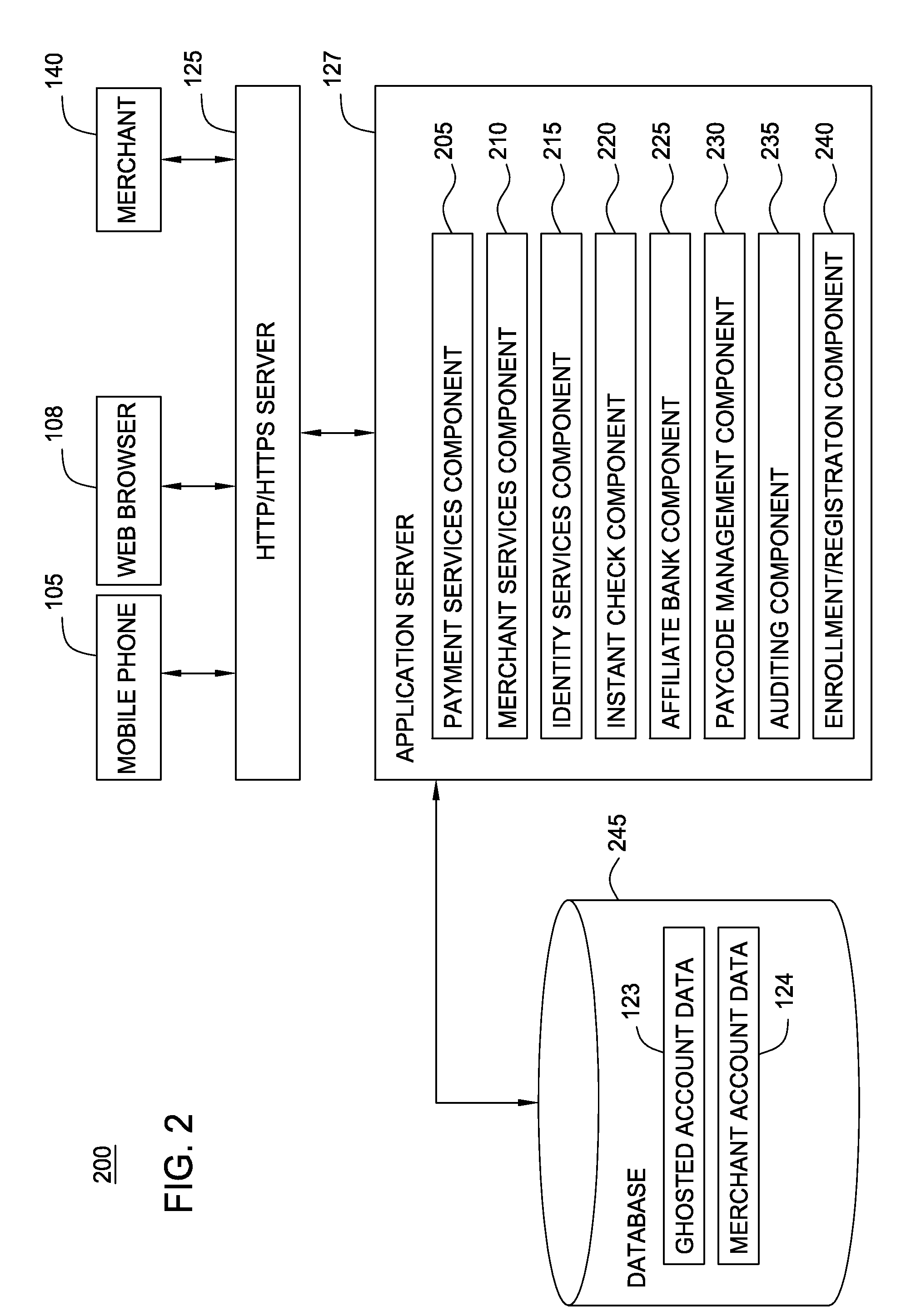

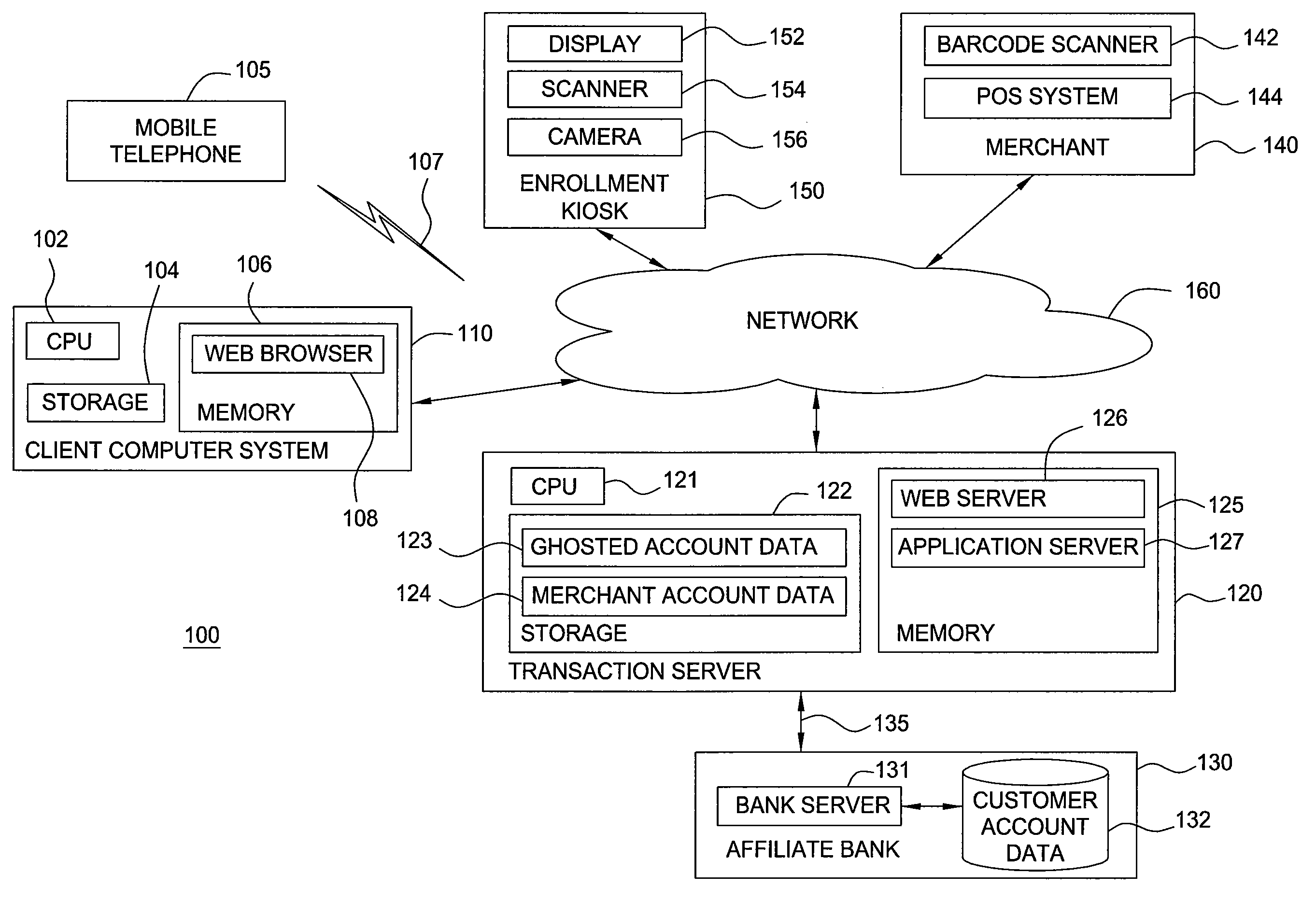

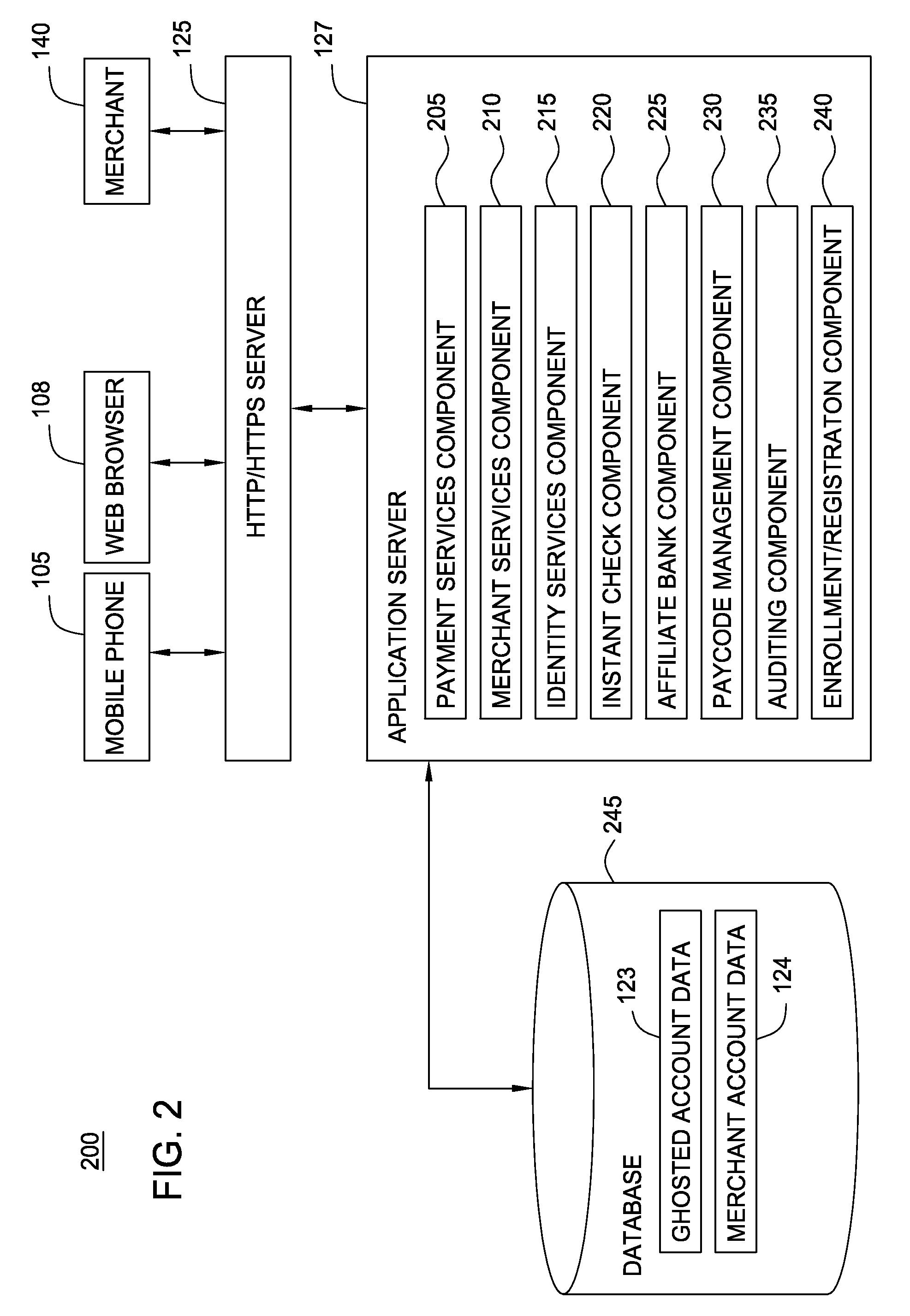

Ghosting payment account data in a mobile telephone payment transaction system

InactiveUS20090254440A1Incurs chargeFinanceSpecial service for subscribersTransaction servicePayment transaction

Techniques are disclosed for a mobile telephone, in conjunction with a payment transaction server, to be used directly as a payment device for a variety of financial transactions. Further, the transaction systems and methods for mobile telephone devices described herein allow a mobile telephone to participate in payment transactions in a manner that helps prevent identify theft and without relying on transferring amounts to / from one stored value account to another.

Owner:GLOBAL 1 ENTERPRISES

Transaction server configured to authorize payment transactions using mobile telephone devices

InactiveUS20090254479A1FinanceUnauthorised/fraudulent call preventionFinancial tradingTransaction service

Owner:GLOBAL 1 ENTERPRISES

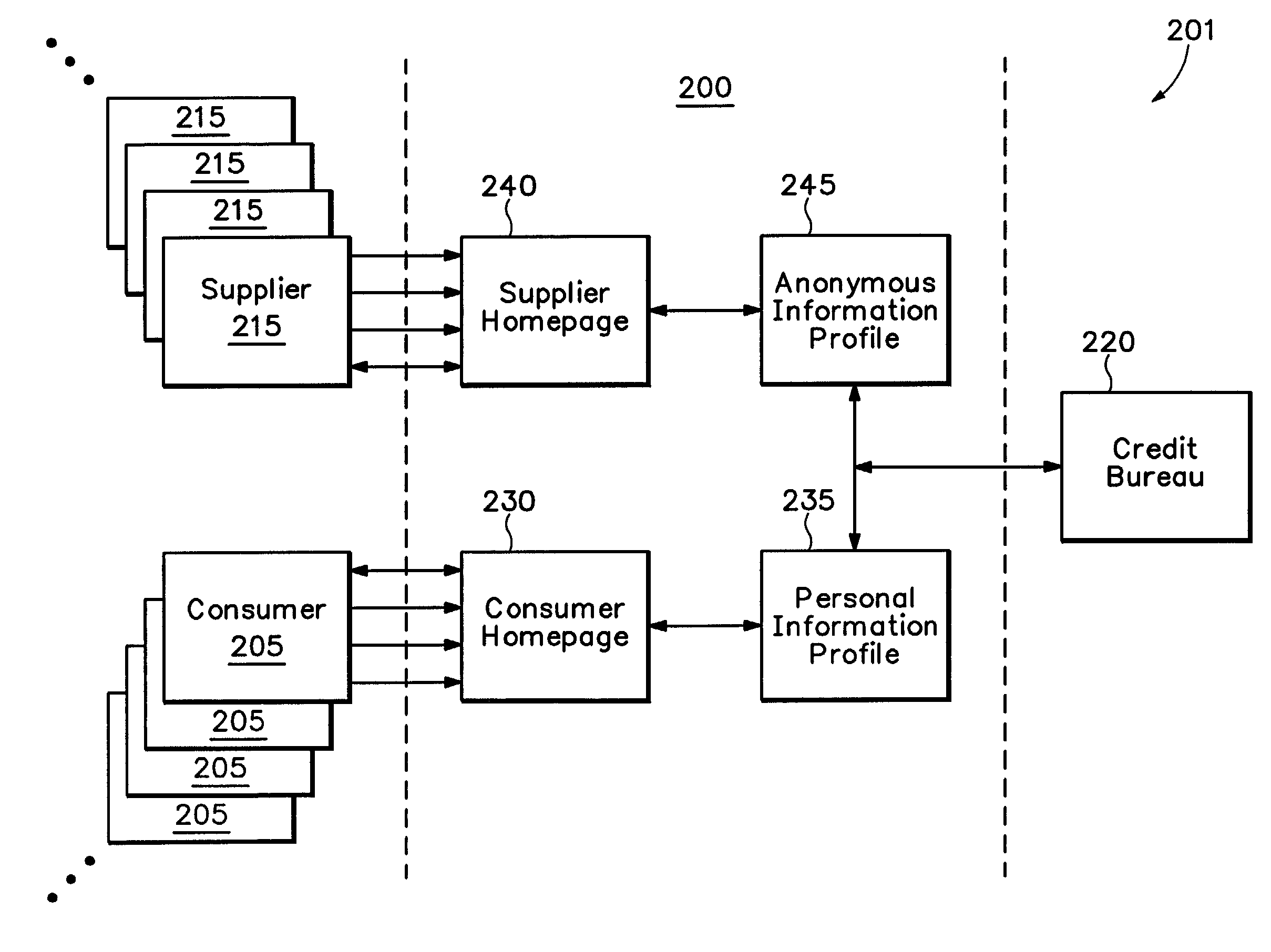

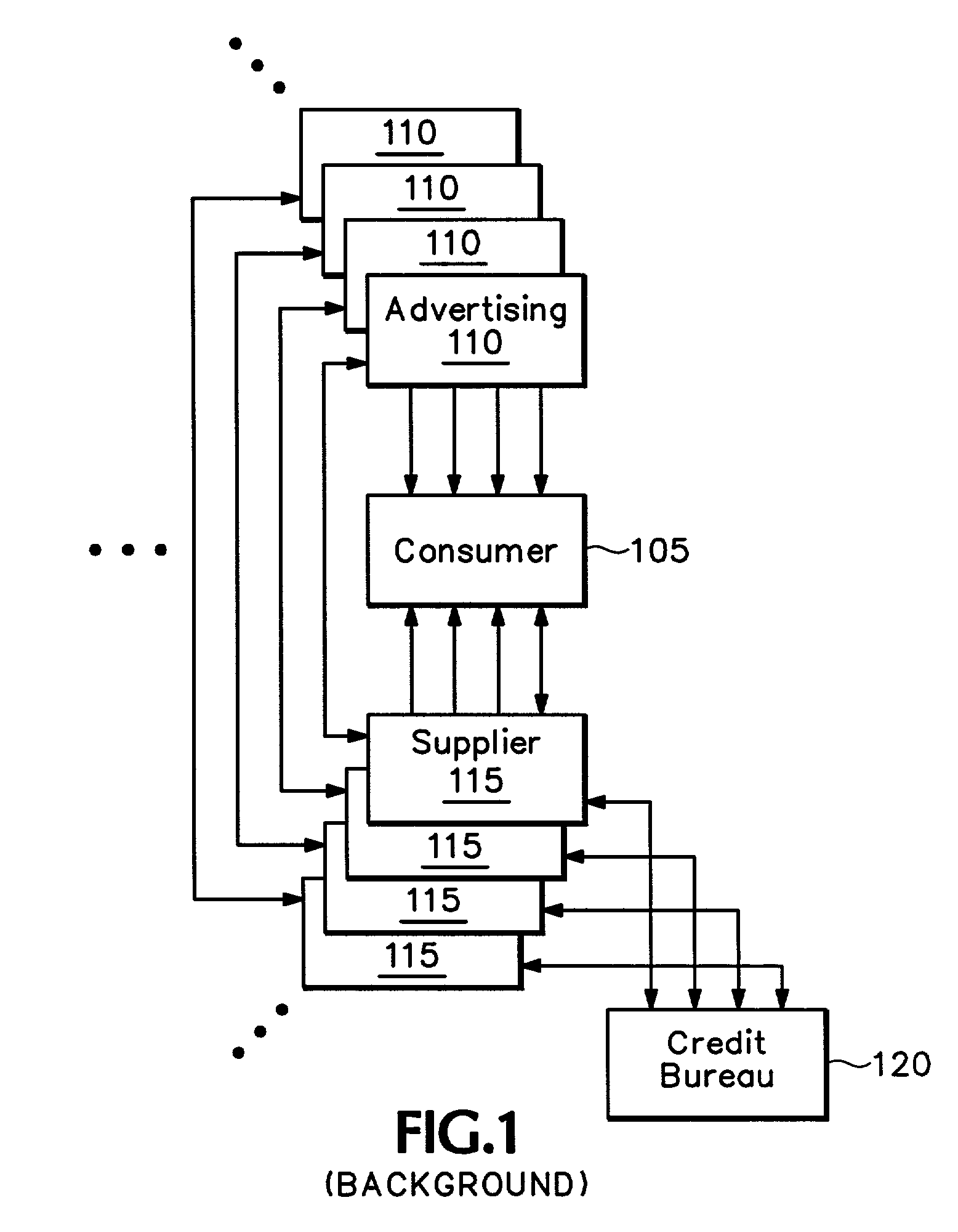

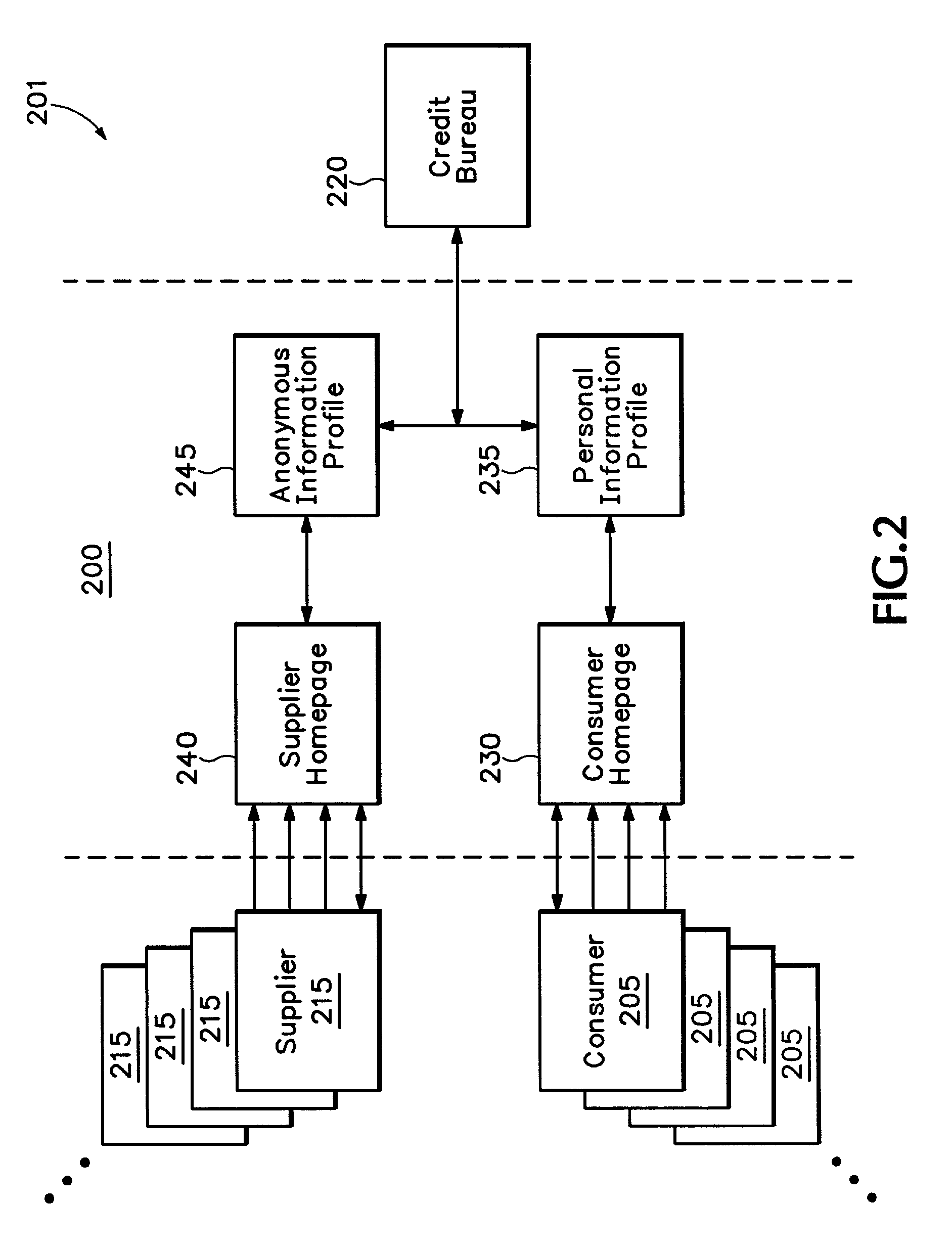

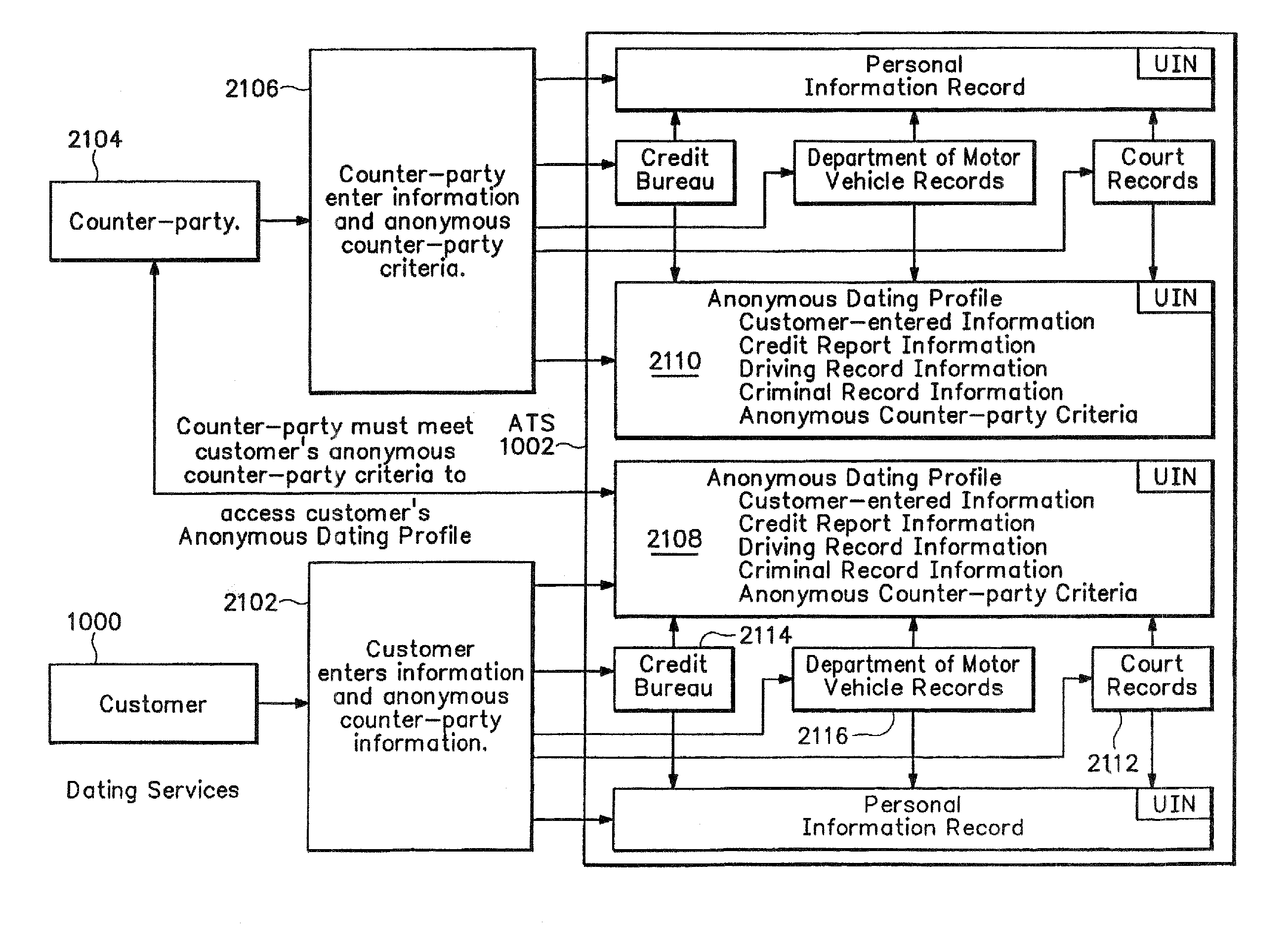

Anonymous transaction system

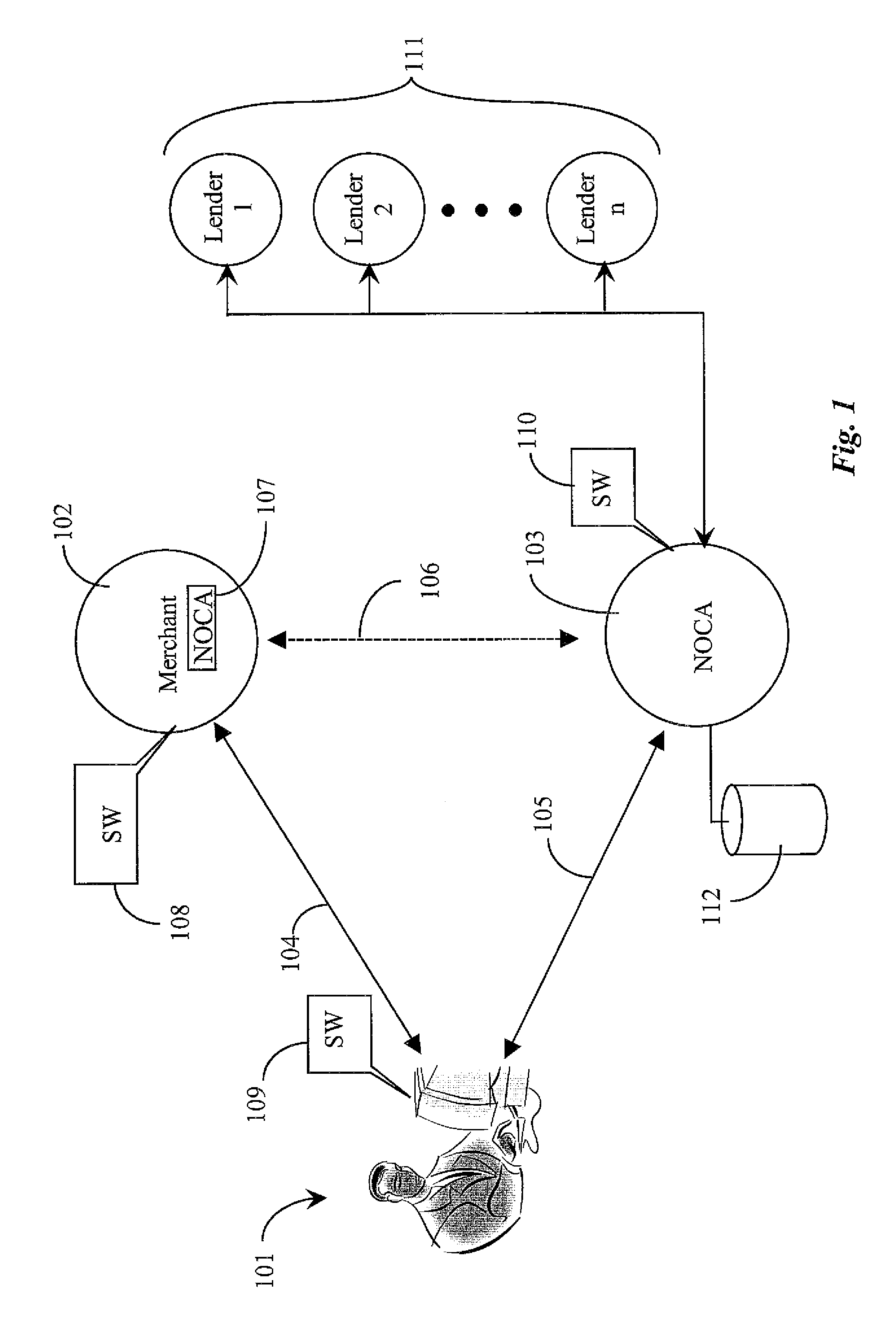

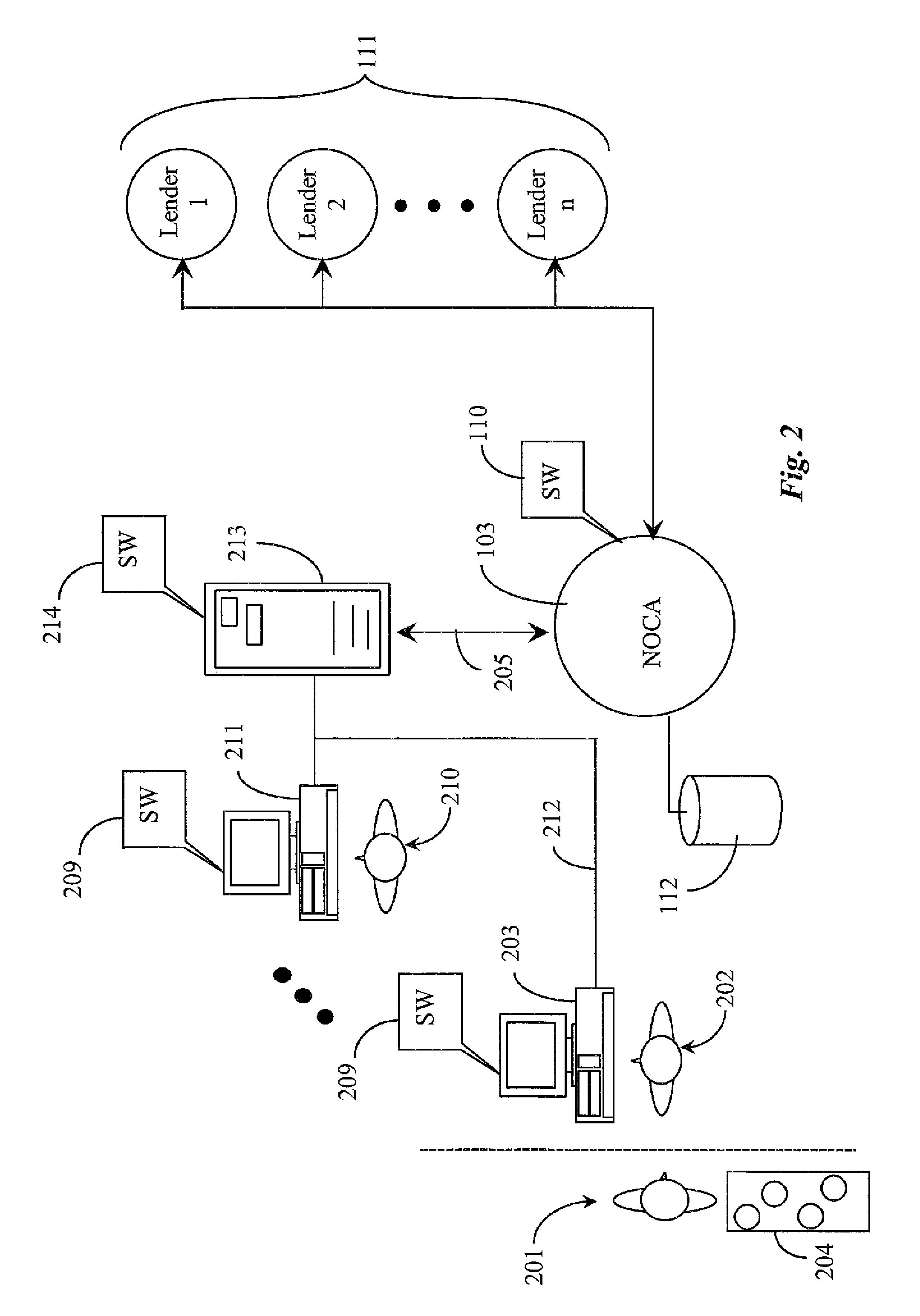

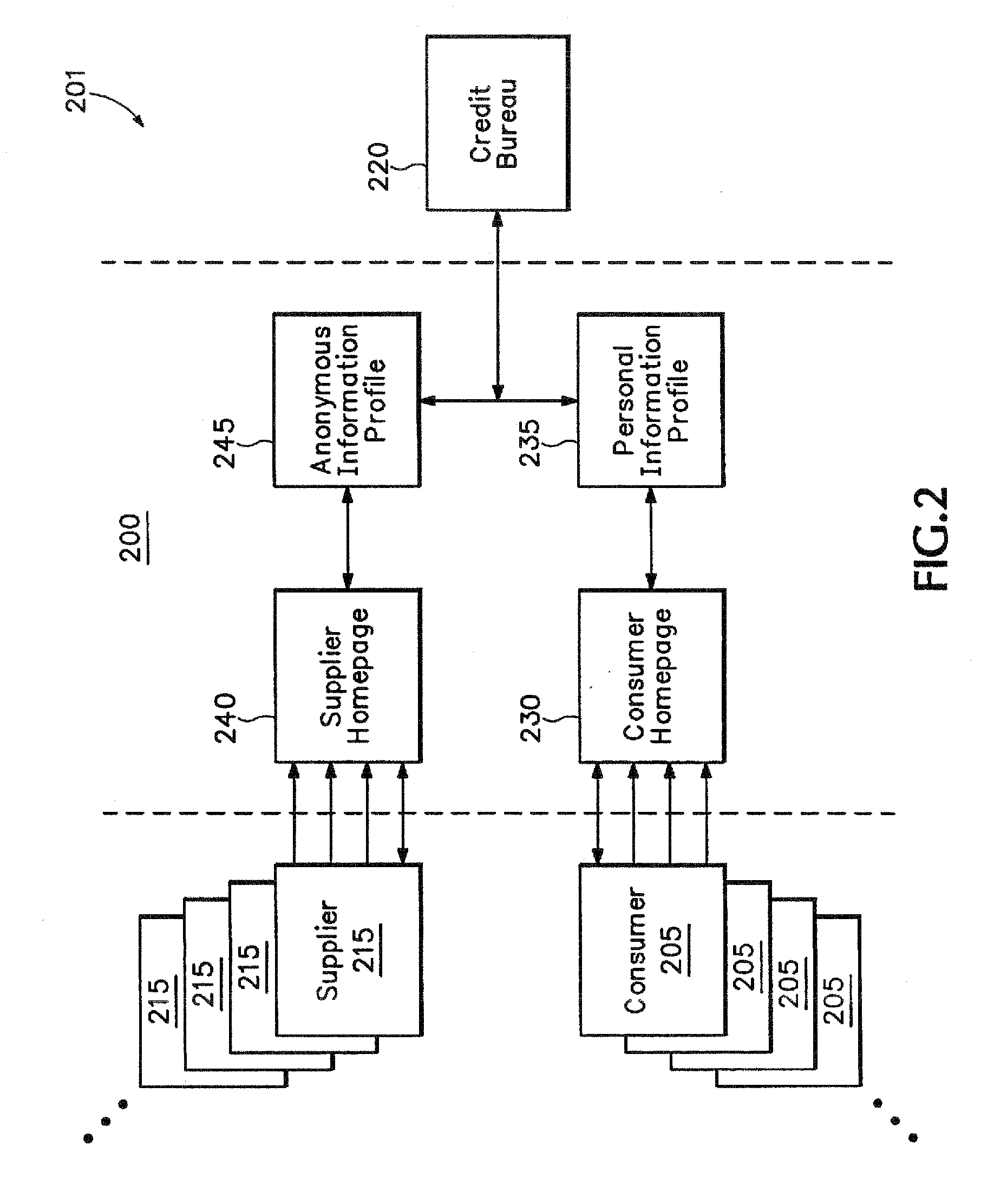

An Anonymous Transaction Service (ATS) solves or alleviates the problems outlined above. The ATS provides anonymous, automated, risk-based differential pricing that allows consumers to receive offers from multiple suppliers with only a single credit report. The ATS facilitates any offer between a supplier and consumer that first requires an evaluation of the risk associated with making the offer. The ATS can be used for any product or service, such as credit cards, home mortgages, automobile loans, appliance loans, debt consolidation loans, insurance products, advertising and dating services, to name only a few.

Owner:NEXTWORTH SOLUTIONS

Transaction system for transporting media files from content provider sources to home entertainment devices

InactiveUS7269854B2Television system detailsMultiple keys/algorithms usageTransaction serviceThe Internet

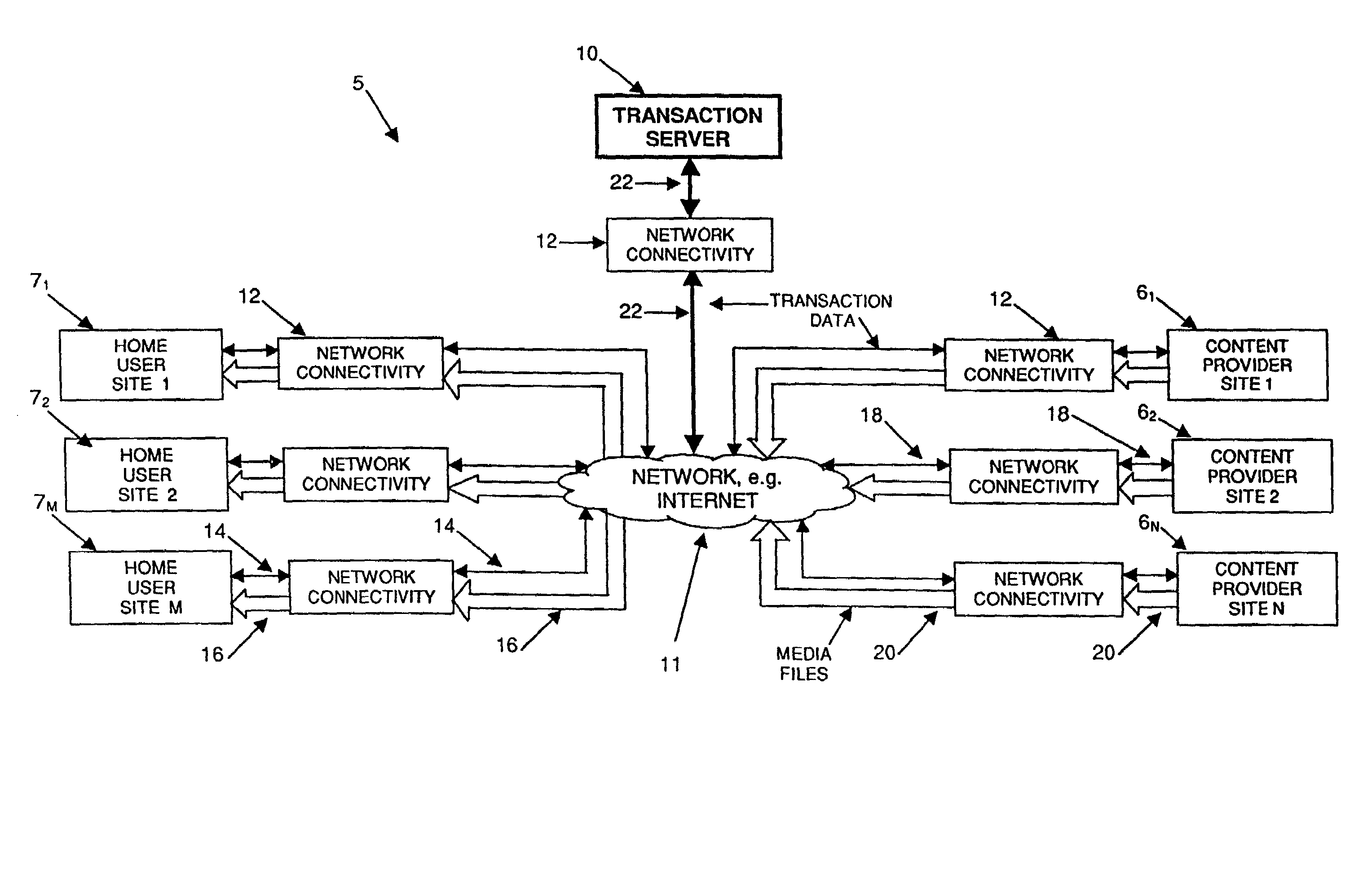

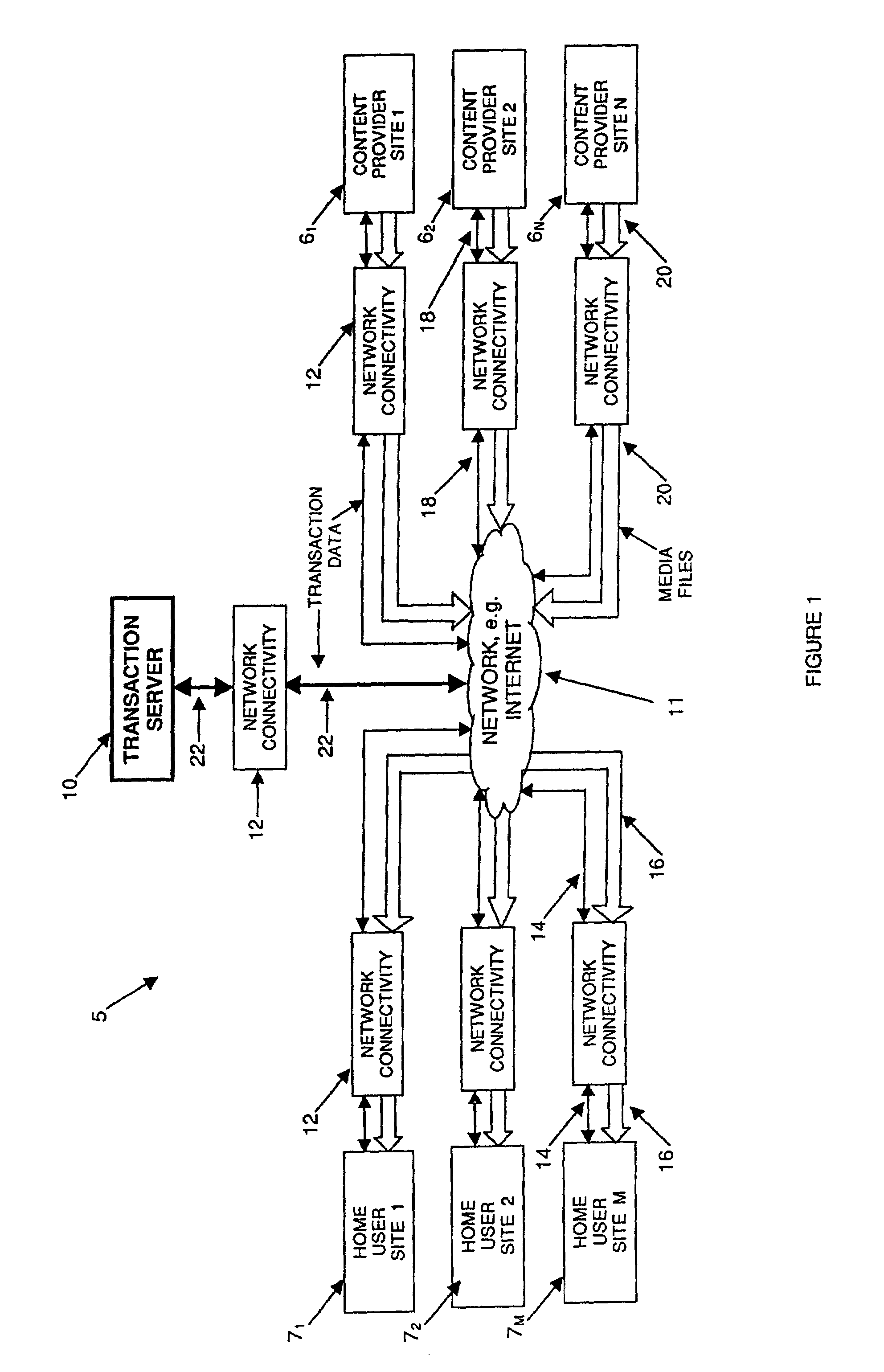

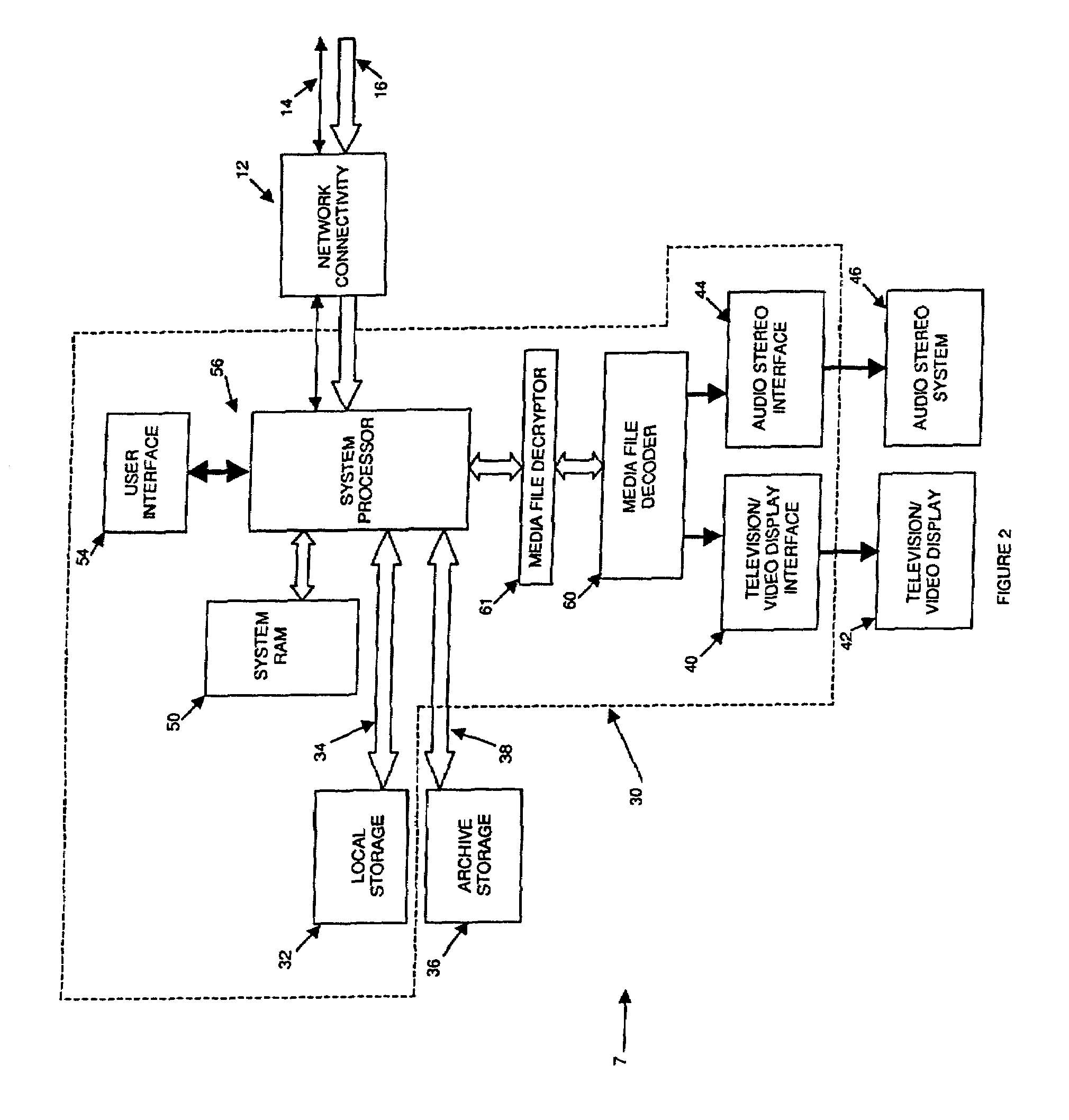

A system and method for enabling a user to request and download selected media files from distributed content provider sites via the Internet. The system includes a plurality of user sites each including a player / receiver housed in an enclosure having a simple user interface, a plurality of content provider sites, and a transaction server site. The player / receiver enables the user to connect to the transaction server via the Internet to access a program guide listing available media files. The user is then able to select a desired file and, via the player / receiver and Internet, request the transaction server to authorize download of the selected file. The file request along with file encryption and transfer instructions are sent from the transaction server via the Internet to the content provider site storing the requested file. Requested files are then dynamically encrypted by the content provider site and securely downloaded to the requesting player / receiver. The requesting player / receiver is uniquely capable of decrypting a downloaded file concurrent with playing back the file on a conventional home television set and / or audio system.

Owner:IMTX STRATEGIC

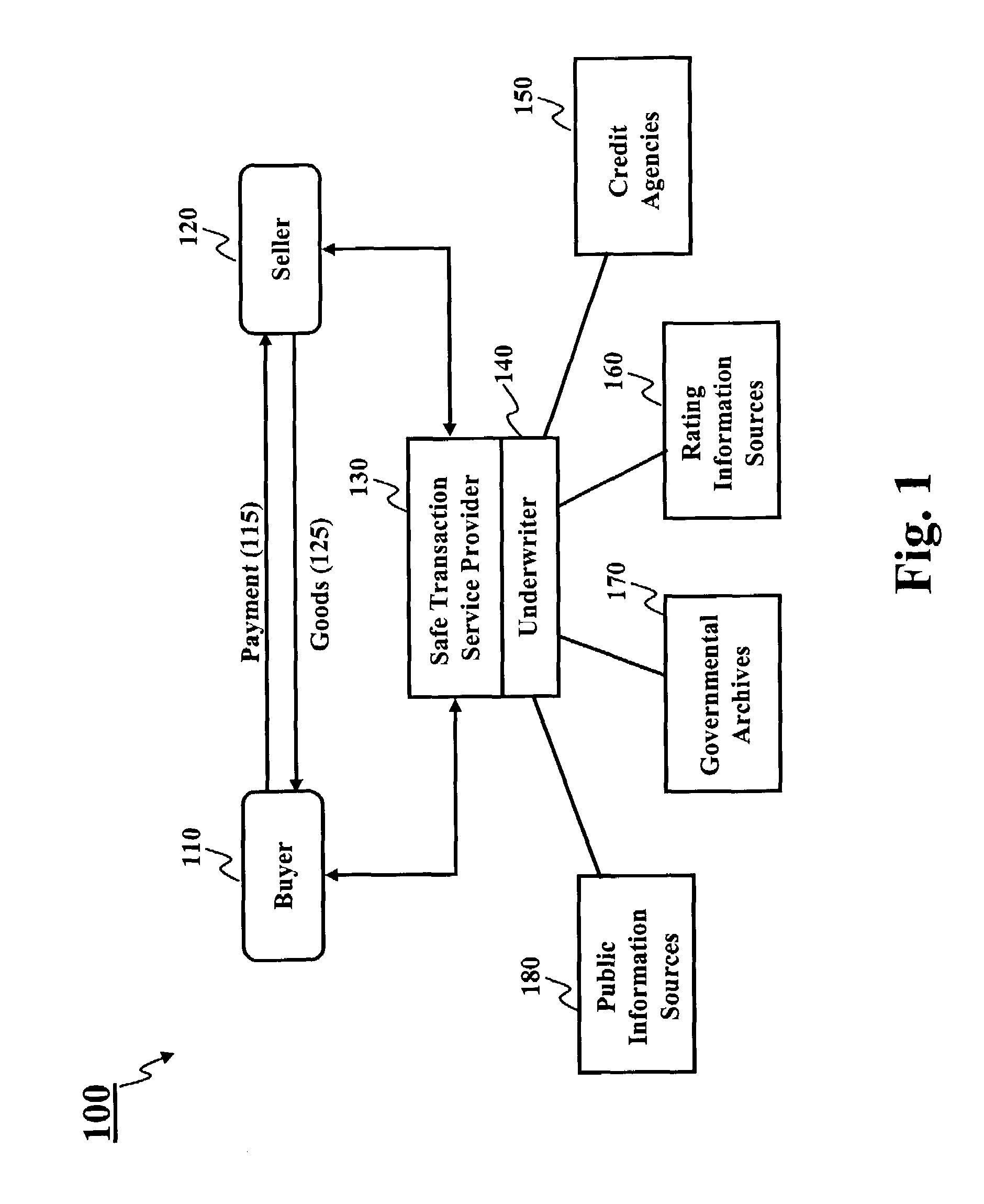

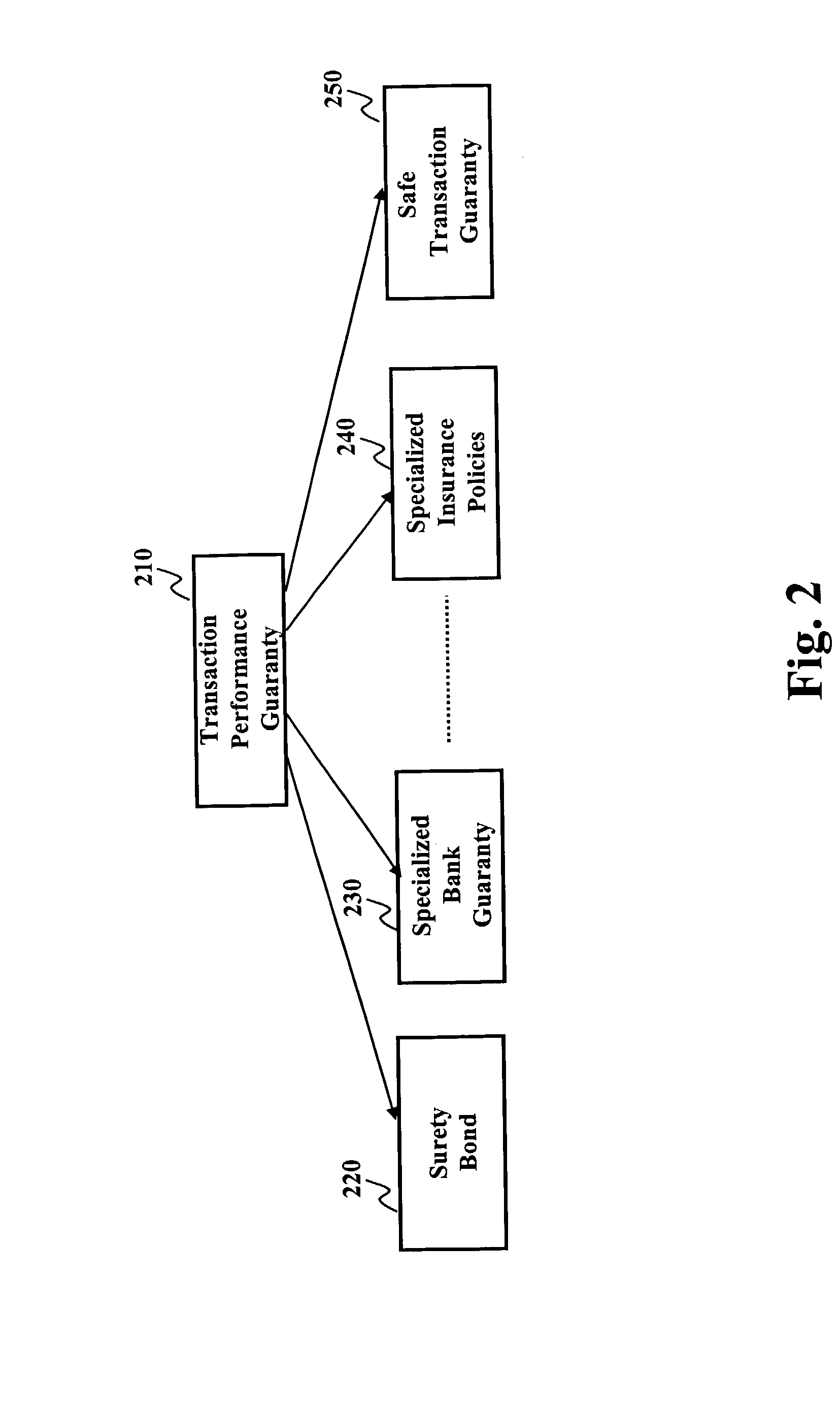

Safe transaction guaranty

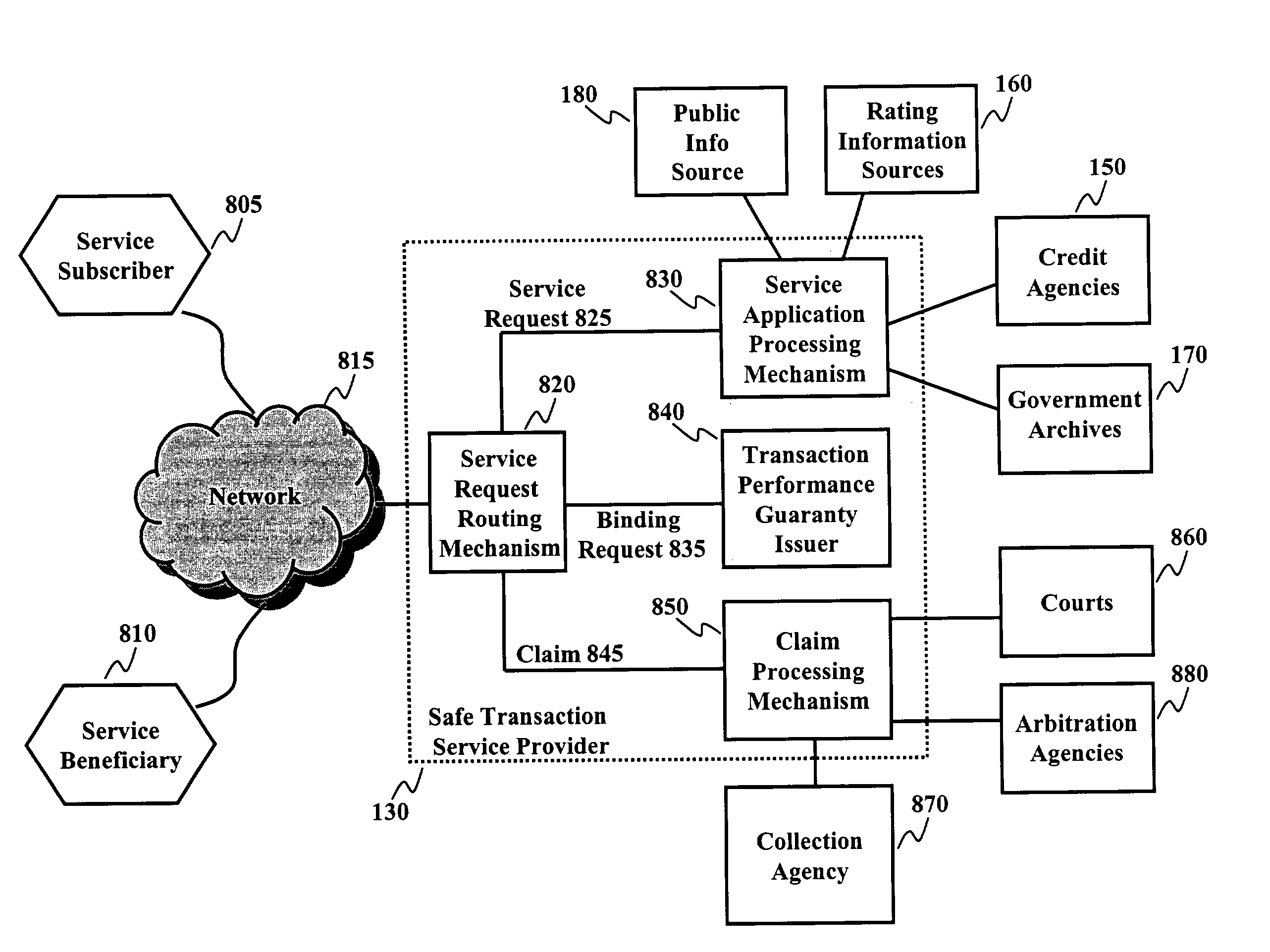

A method and system is provided for safe online commercial transaction. When a safe transaction service provider receives a request from a first party for obtaining a transaction performance guaranty service, the safe transaction service provider processes the request by underwriting the first party. If the underwriting is successful, the transaction performance guaranty service is provided to the first party which binds a transaction performance guaranty to an online commercial transaction involving the first party and guarantees the first party's performance when the first party and a second party enter the online transaction.

Owner:BUYSAFE

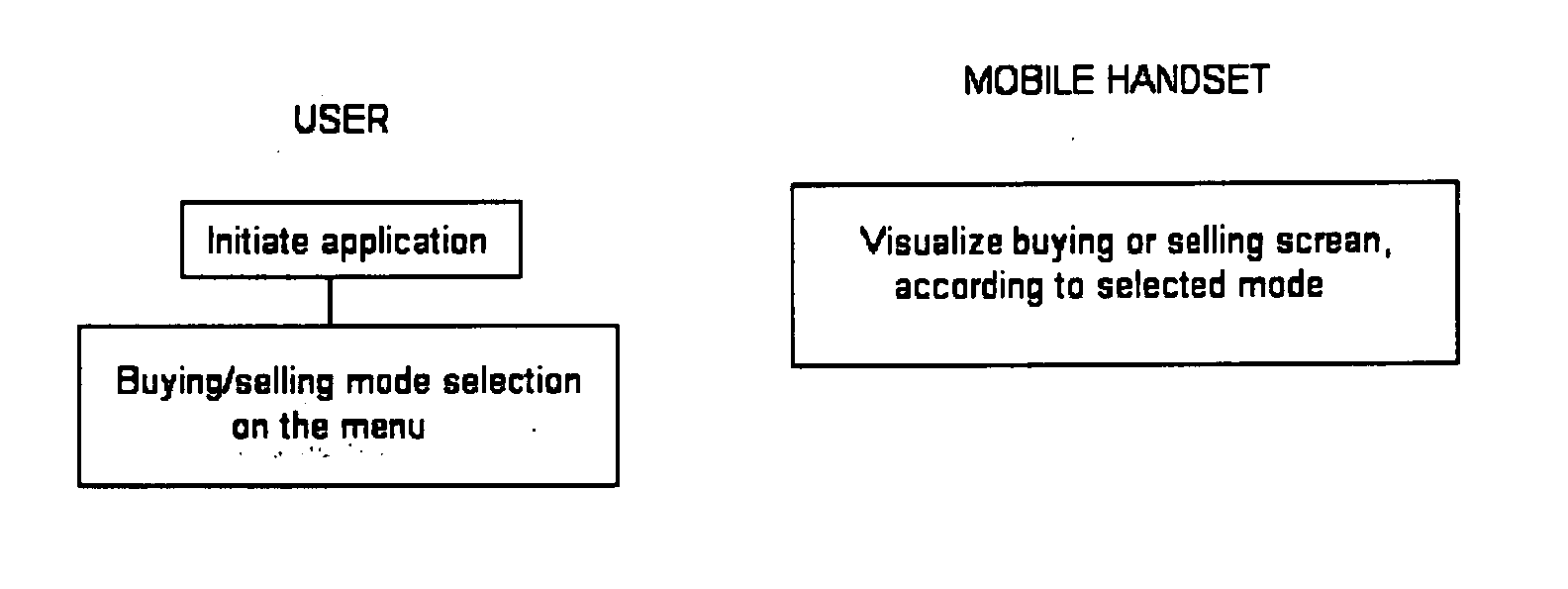

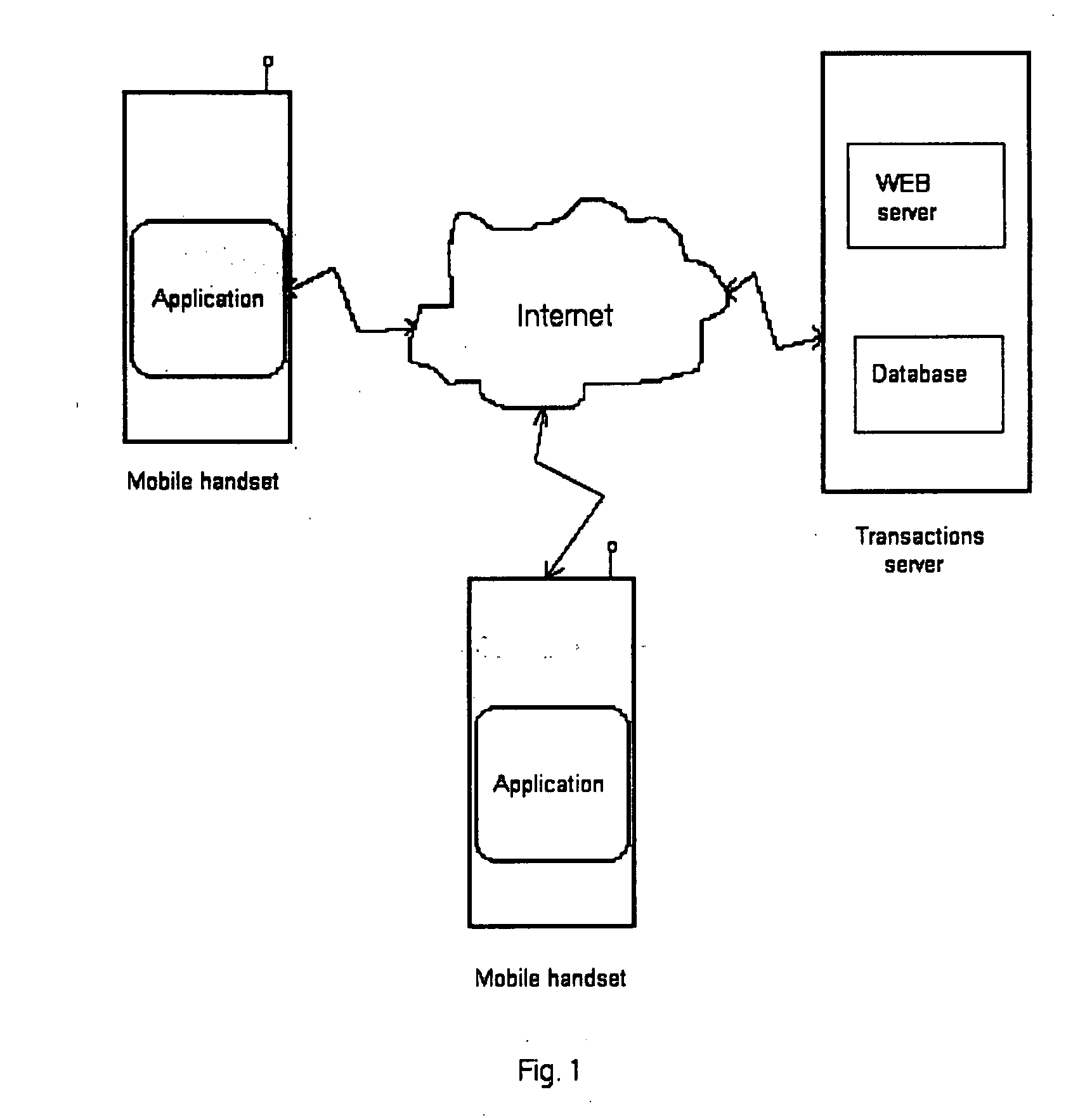

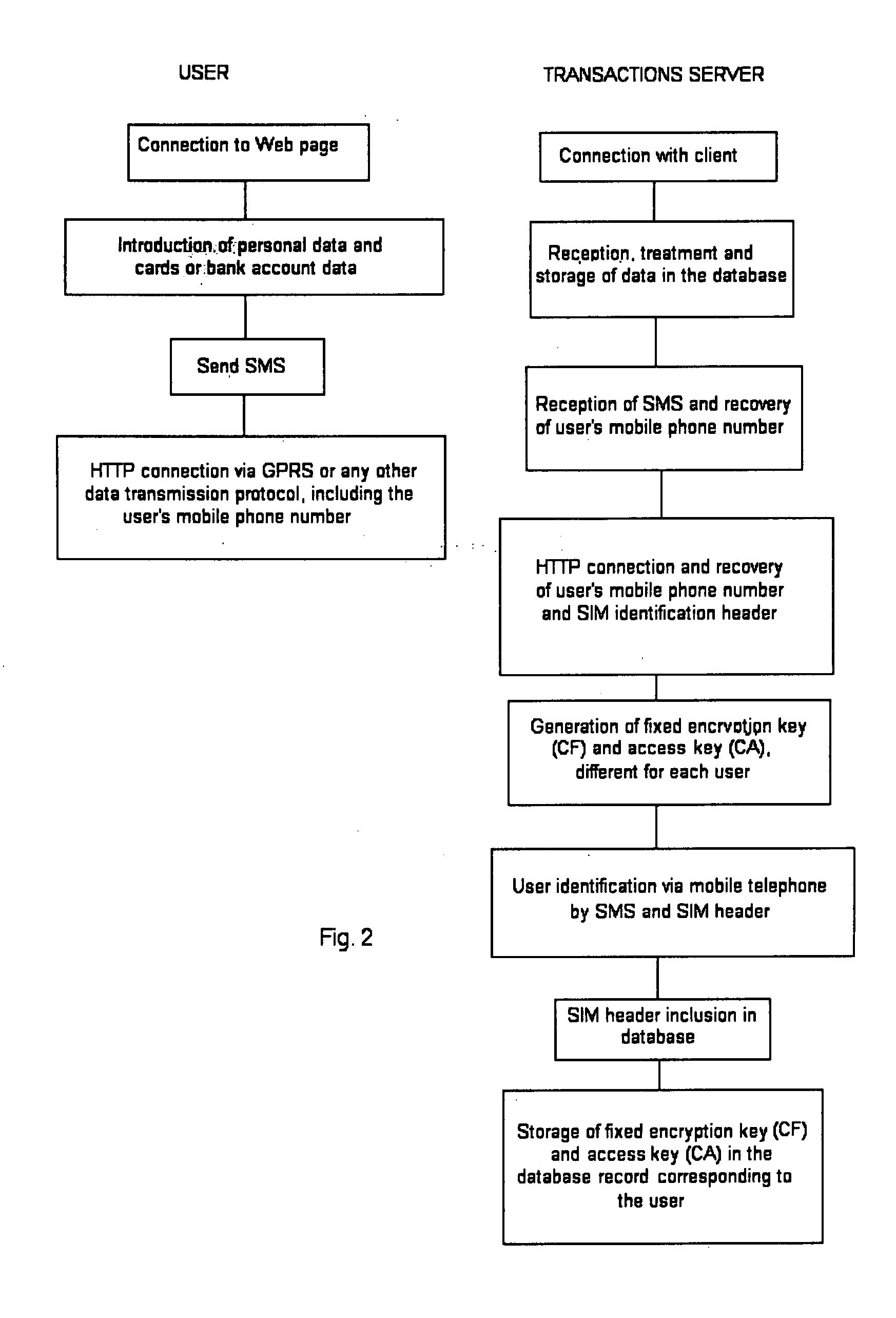

Method To Make Payment Or Charge Safe Transactions Using Programmable Mobile Telephones

InactiveUS20080091614A1Flexible systemRobustness and safetyComplete banking machinesAcutation objectsPaymentTransaction service

This is a method to carry out safe transactions using programmable mobile telephones. The use of programmable handsets—for example with Java technology—, to which an application is downloaded (e.g. Java application) allows people to carry out safe transactions. The application allows the buyer / seller to carry out the transaction, including the verification, with just one connection. The data that was sent is then encrypted and transmitted via GPRS or any other data transmission protocol, to a transactions server, where the transactions are verified and authorised. The security of the process is provided mainly by the use of up to five non related identification elements, including an access key unique for each user, stored in the mobile handset.

Owner:ETRANS L C

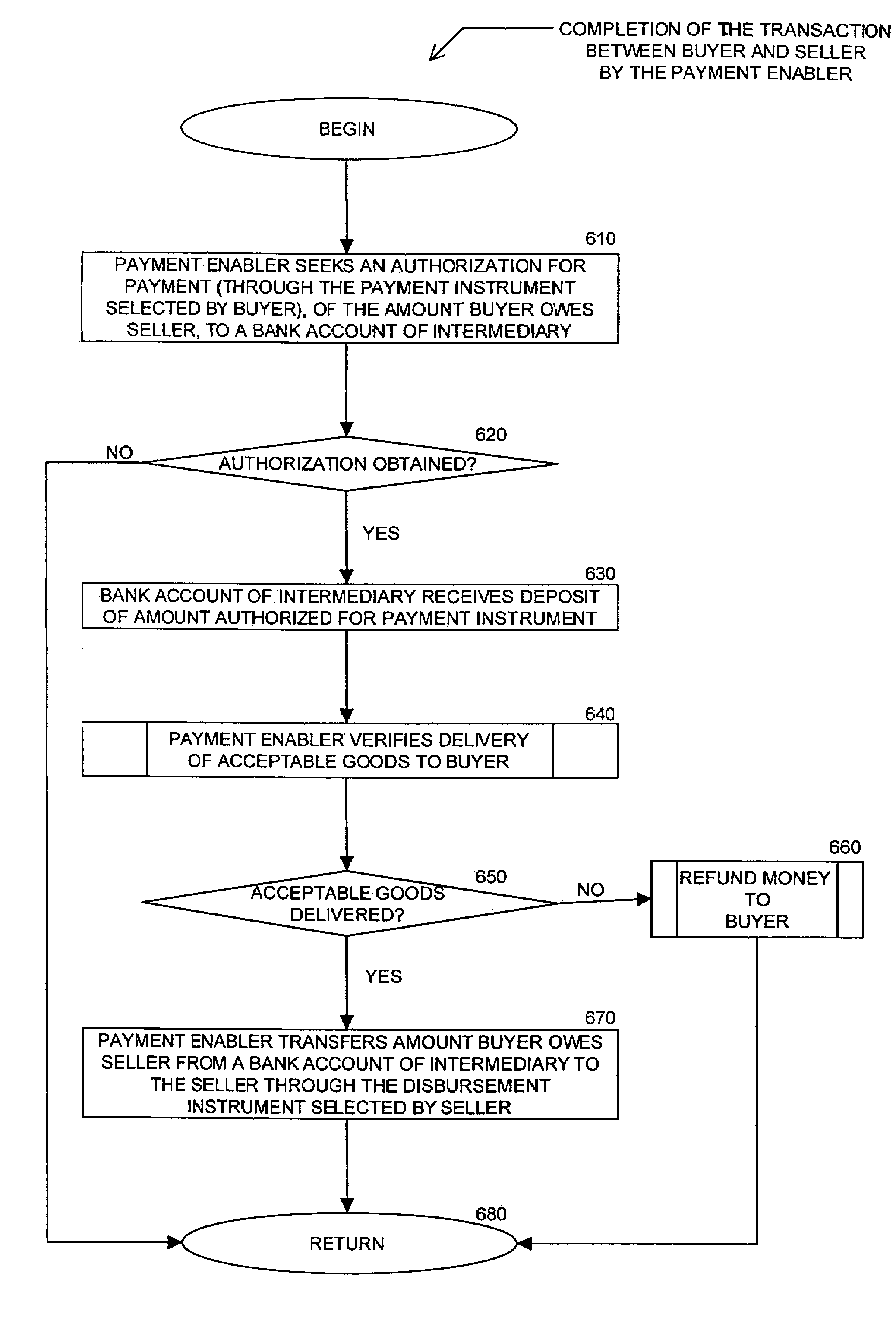

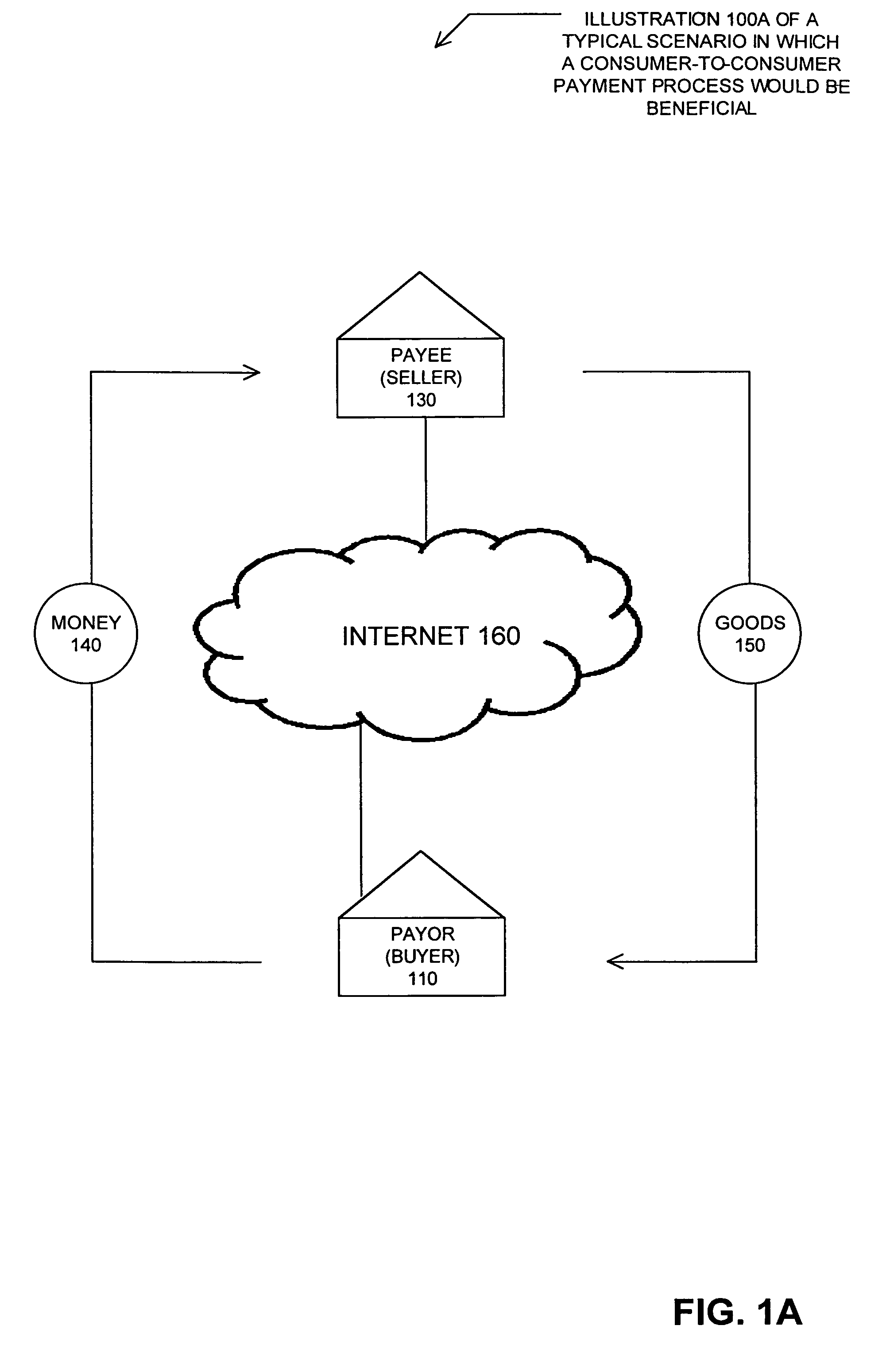

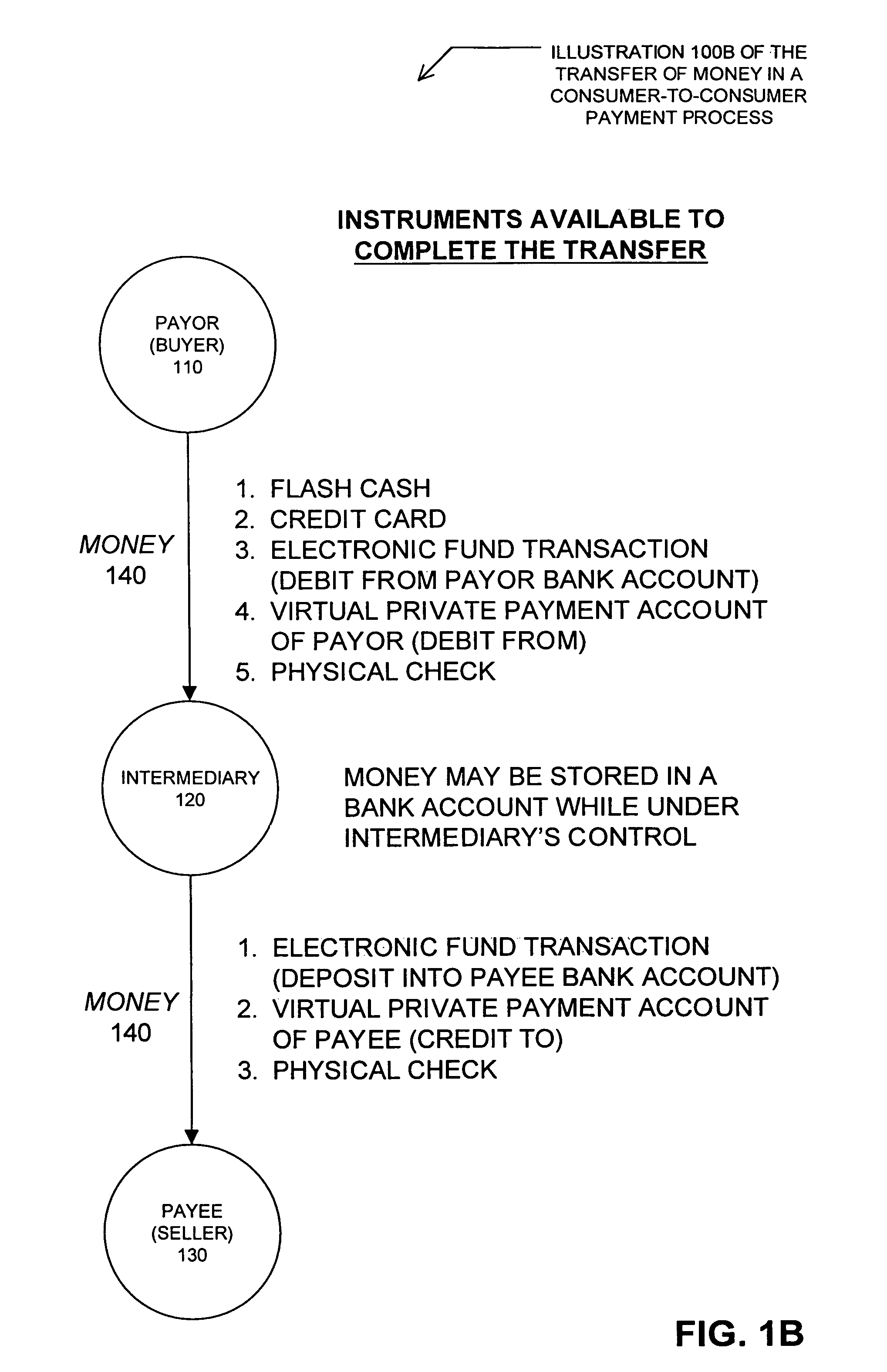

Method and system for payment transactions and shipment tracking over the internet

InactiveUS7593898B1Reduce the risk of fraudFinanceMultiple digital computer combinationsTransaction servicePayment transaction

A method for completing a transaction in response to a determination that goods have been acceptably delivered to a buyer. The method is particularly suitable for use in an online commerce system including a transaction computer operated by a transaction facilitator and a pre-authorized shipping service. After a transaction is initiated, payment instrument selection information is displayed to the buyer, who selects a payment instrument. Authorization for the payment instrument is obtained from a payment instrument processor. Instructions are communicated to the seller to ship the goods using the shipping service. Transaction information including a tracking number associated with the shipment of the goods is stored. A tracking database of the shipping service is queried to determine whether the goods have been delivered. If the goods have been delivered to and accepted by the buyer, an instruction is communicated to the payment instrument processor to make payment to the seller.

Owner:FIRST DATA

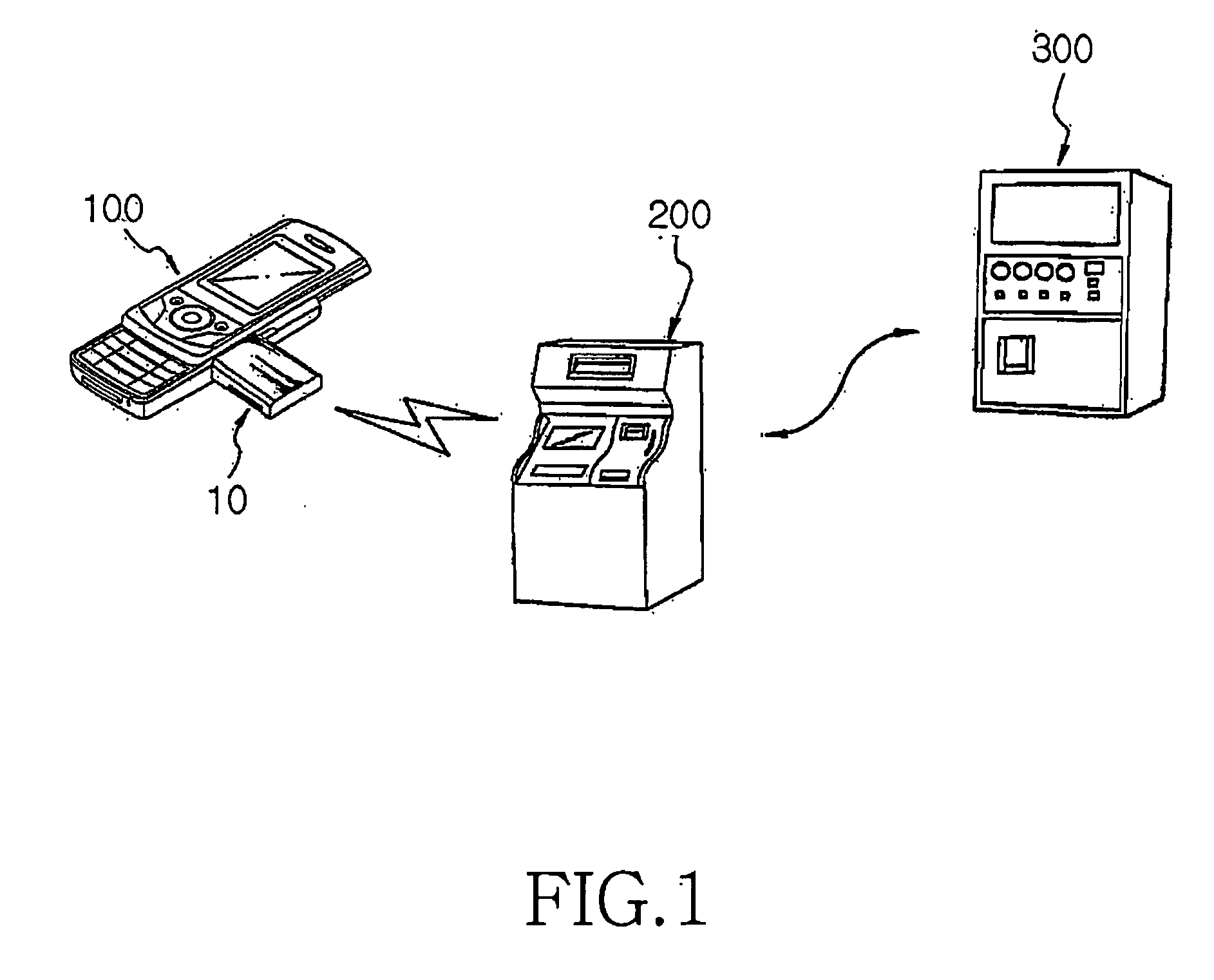

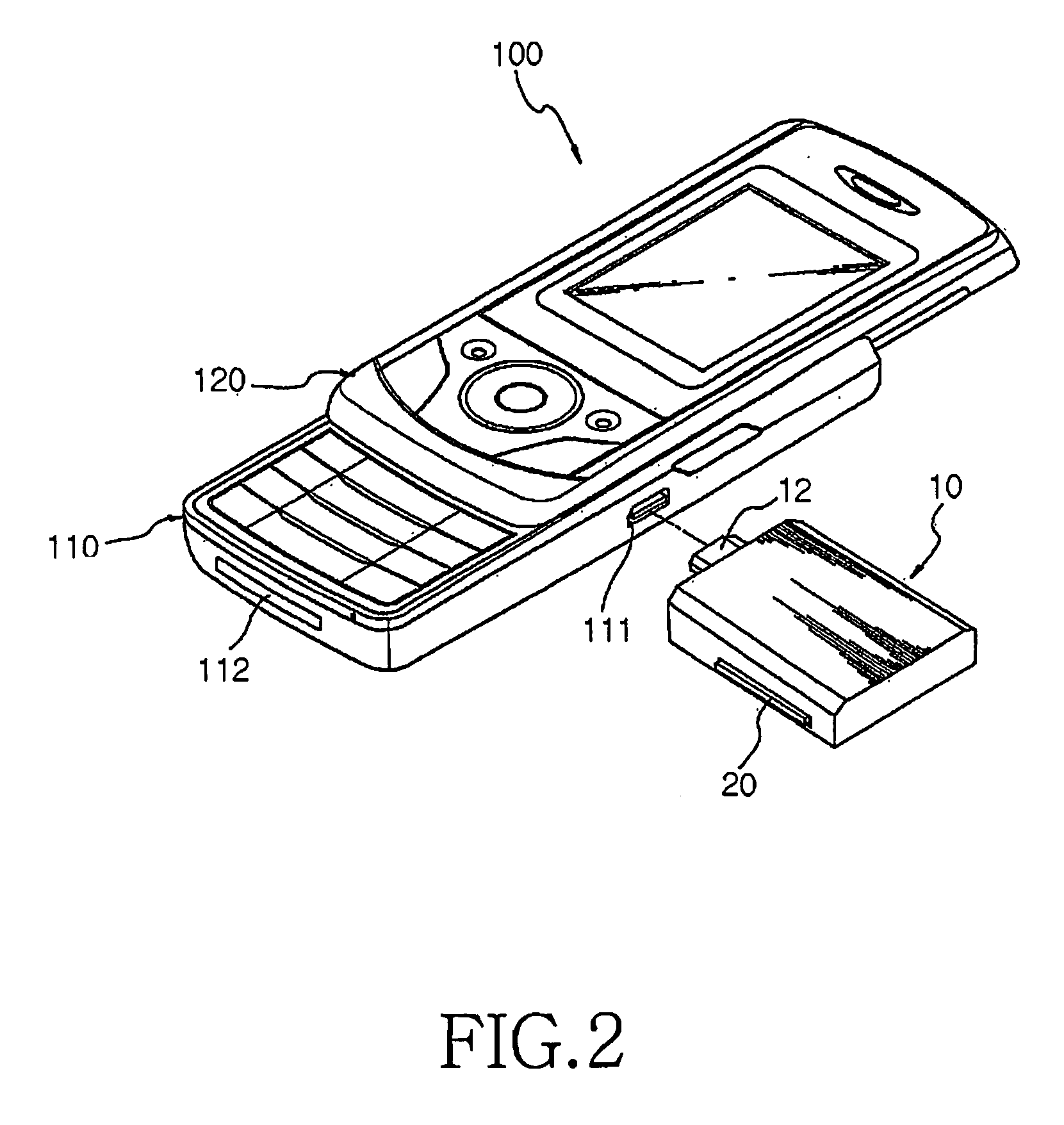

Multi-functional dongle for a portable terminal

InactiveUS20070235519A1Convenient banking transaction serviceGood serviceComplete banking machinesAcutation objectsTransaction serviceSound sources

Provided is a dongle that is connected to a portable terminal for providing a mobile banking transaction service with a banking equipment that includes a banking transaction unit for providing a mobile banking transaction service with a banking equipment; an FM transmitter for outputting a sound source played in a portable terminal through a speaker of an external FM receiver; a charger for receiving an external voltage to charge the portable terminal; and a connector to be connected to the portable terminal simultaneously or individually in order to perform functions of the banking transaction unit, the FM transmitter, and the charger. The banking transaction related components are implemented with a single separate device, i.e., dongle, and can be mounted when necessary. Therefore, a separate banking related module (software and / or hardware) is unnecessary, thereby slimming the portable terminal. In addition, the convenience of the banking transaction is improved because the dongle can be applied to general terminals having a minimum software specification.

Owner:SAMSUNG ELECTRONICS CO LTD

Method, system, and computer program product for providing transaction services

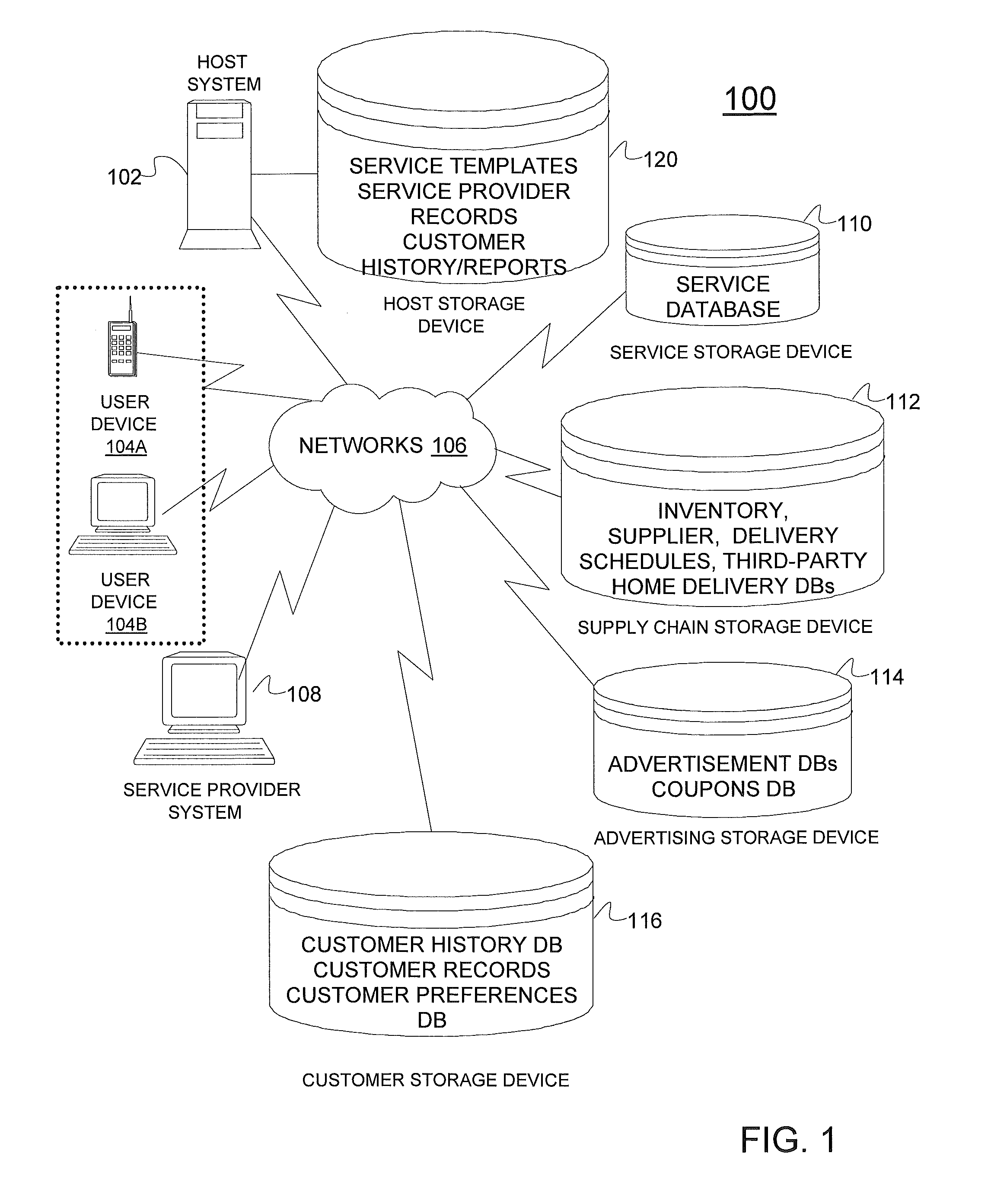

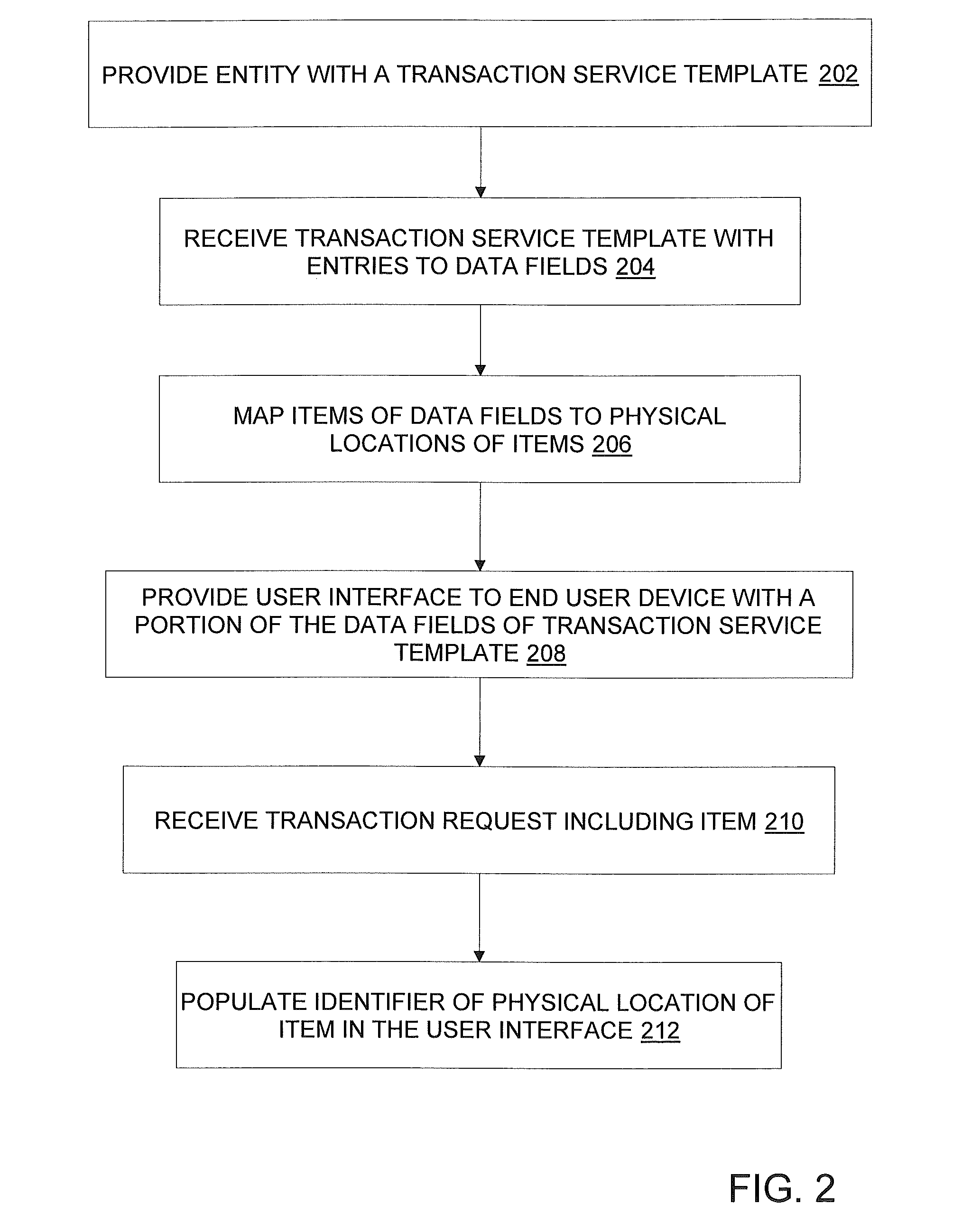

Transaction services include providing, to a computer system of an entity via a first user interface, a transaction service template having data fields configured to specify items and identifiers of physical locations in which each of the items resides. The transaction services also include receiving the transaction service template including entries presented in the data fields, the transaction service template mapping the items to corresponding physical locations. Transaction services further include providing a second user interface to an end user device, the second user interface including a portion of the data fields of the transaction service template. In response to a transaction request that includes one of the items, the transaction services also include populating an identifier of a corresponding physical location of the item in the transaction request within the second user interface as a transaction response.

Owner:AT&T INTPROP I L P

Credit and transaction systems

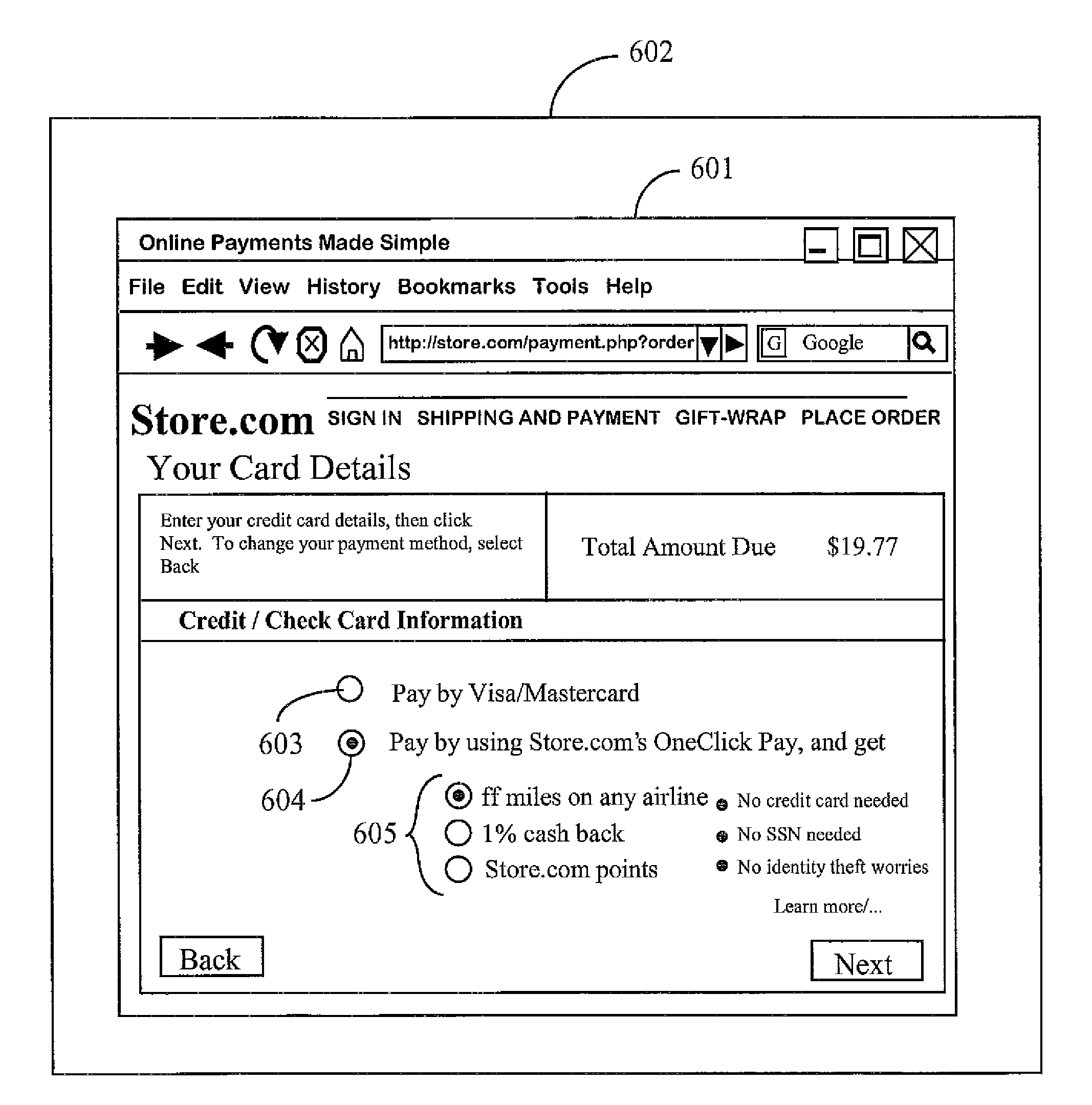

An Internet-coupled transaction service has a link to a computer appliance coupled to a merchant site, the computer appliance operated by a person who has selected one or more products or services to purchase at the merchant site, and who has selected, through the merchant site, the transaction service to arrange payment, and software executing from a computer-readable medium accessible to the service. The transaction service, via the software verifies the identity of the person, determines a credit worthiness for the person, and the score being sufficient, arranges payment to be made to the merchant on behalf of the person, and arranges repayment terms with the person for the payment to the merchant.

Owner:INTELLECTUAL ADVANCE

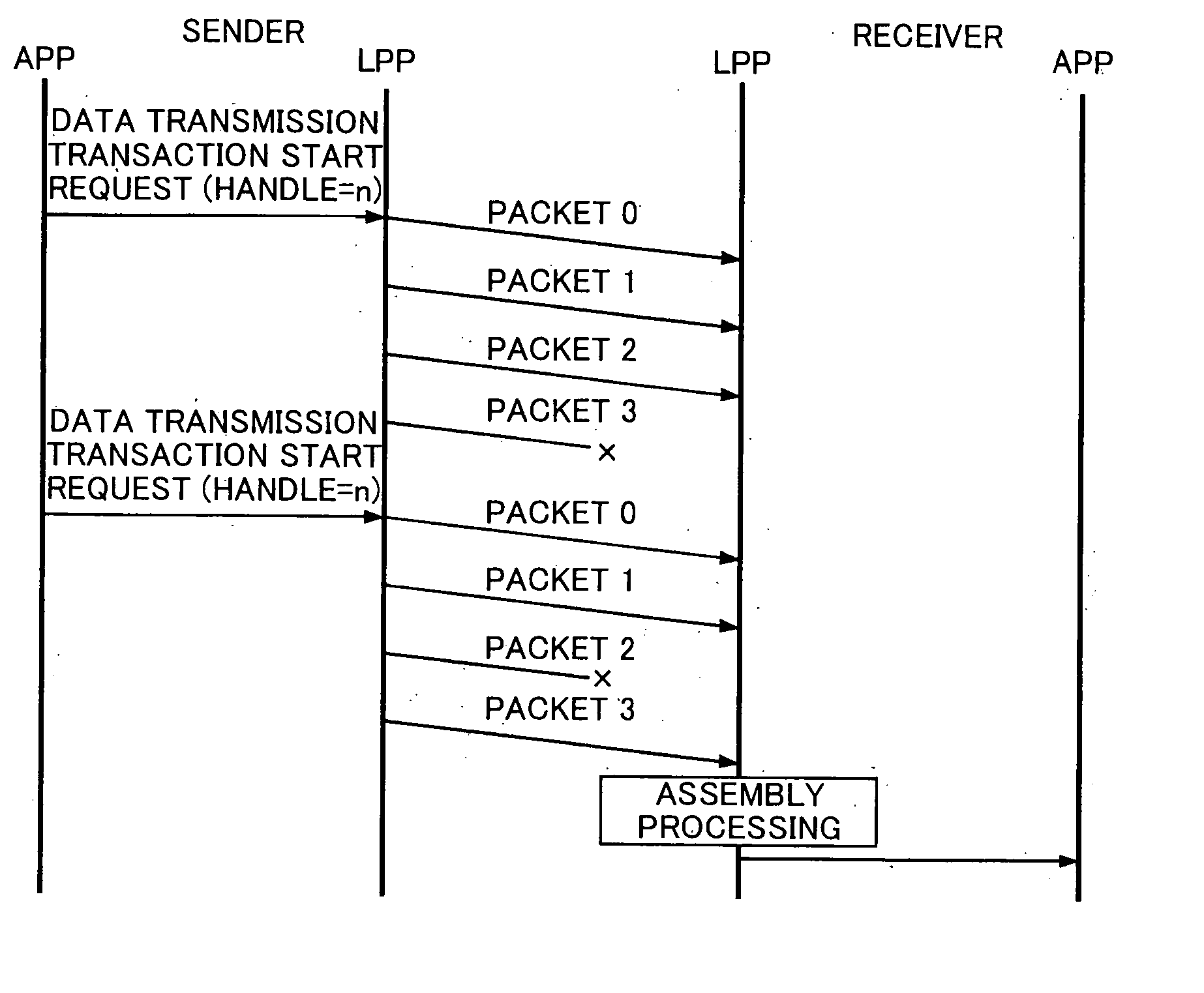

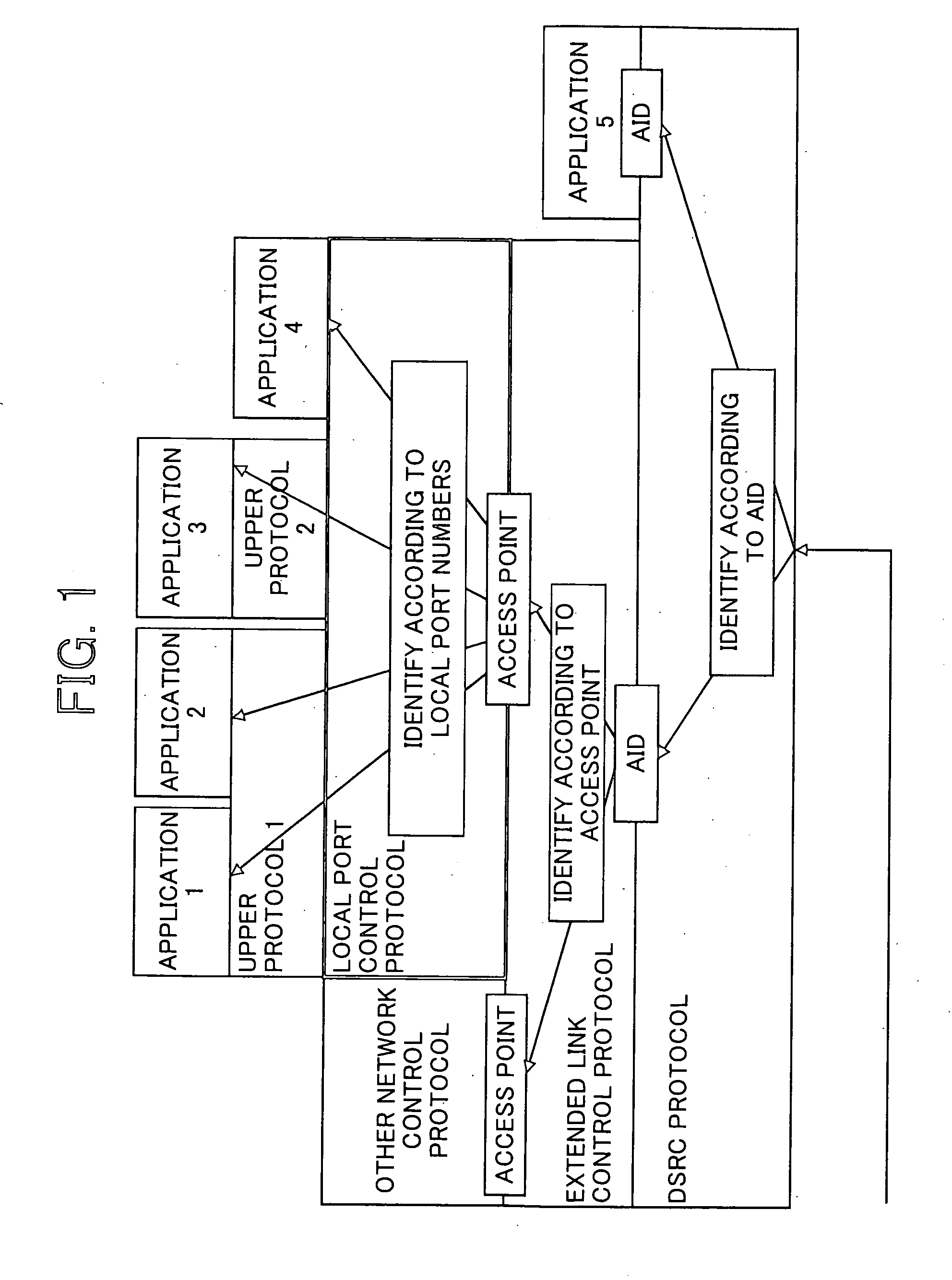

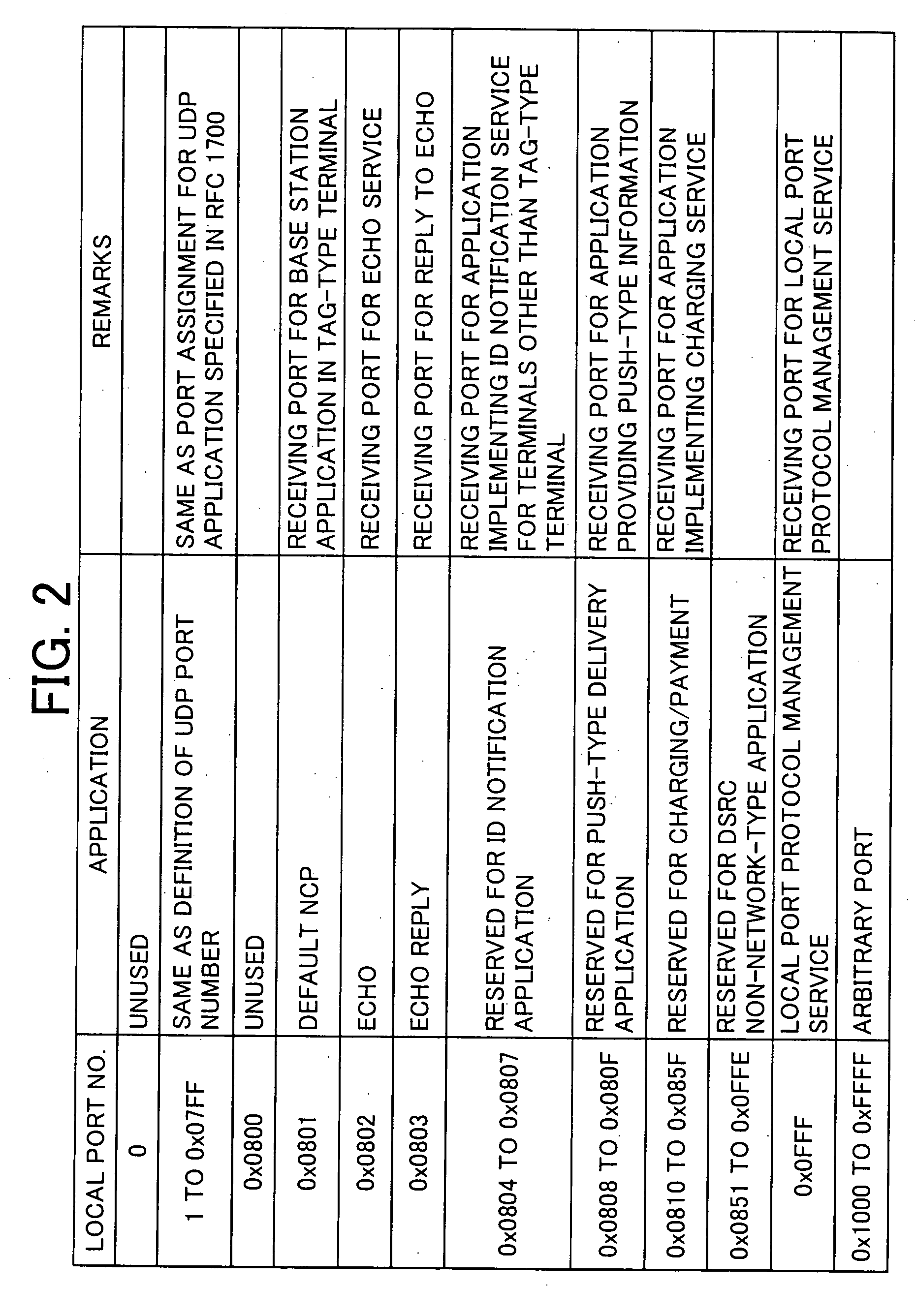

Between-load-and-vehicle communication system

InactiveUS20060193282A1High error rateReduce overheadError prevention/detection by using return channelNetwork traffic/resource managementTransaction managementTransaction service

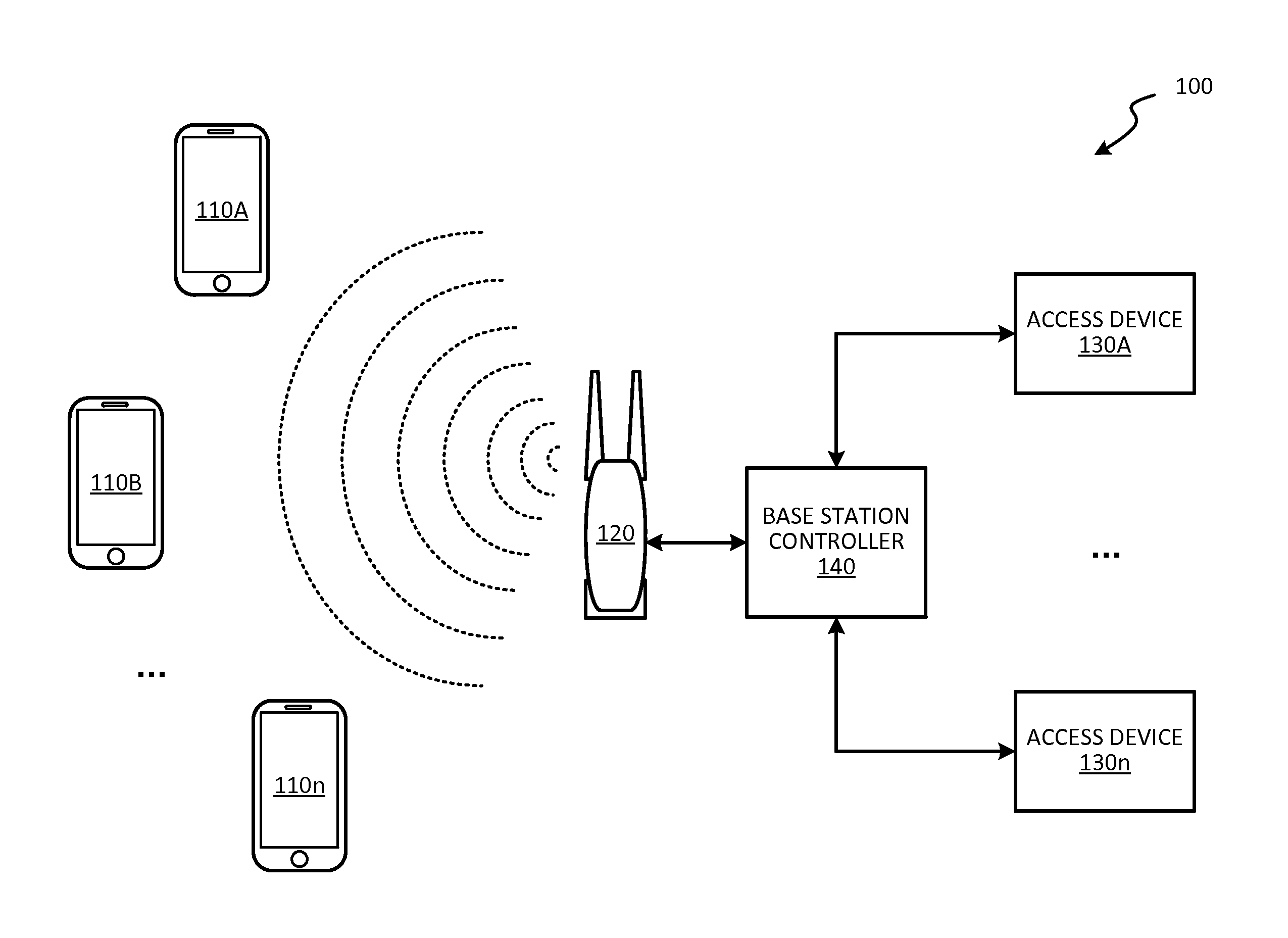

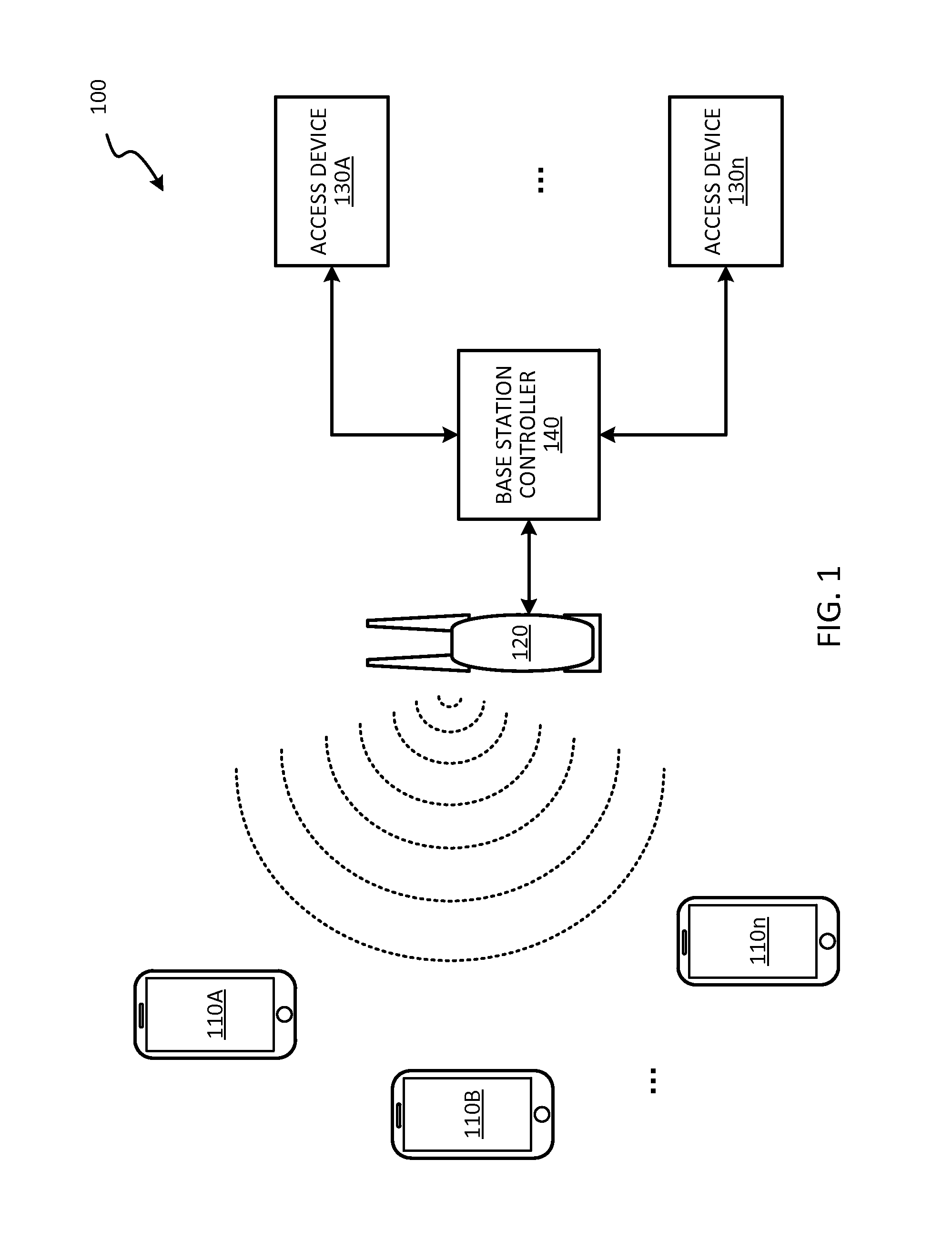

A roadside-to-vehicle communication system for providing a mobile station with application service by utilizing roadside-to-vehicle communication implemented between the mobile station that travels on a road and a base station system installed along the road provides non-network-type communication protocols that can implement diverse application services, even when the mobile station is moving. The roadside-to-vehicle communication system includes transfer service processing entities for implementing data transfer among applications and transaction management entities have undelivered data resenders, data send / receive for each message, and a message segmenter / assembler that provides unidirectional data transmission and request-response transaction services.

Owner:MITSUBISHI ELECTRIC CORP

Transactional services

InactiveUS20110321127A1Improve readabilityHinder the usability of the universal electronic transaction facilityDigital data processing detailsCryptography processingTransaction serviceService provision

Owner:MASTERCARD MOBILE TRANSACTIONS SOLUTIONS

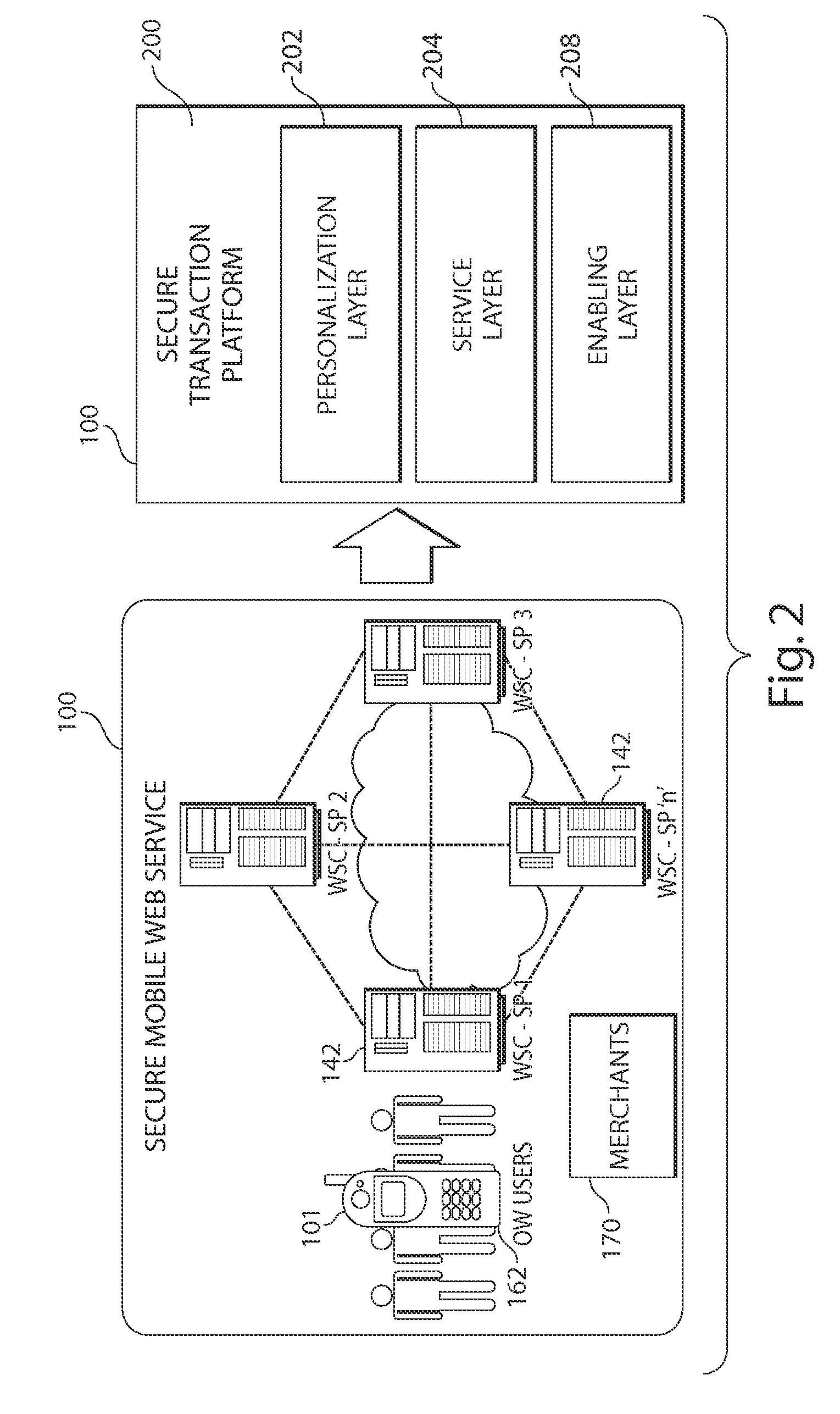

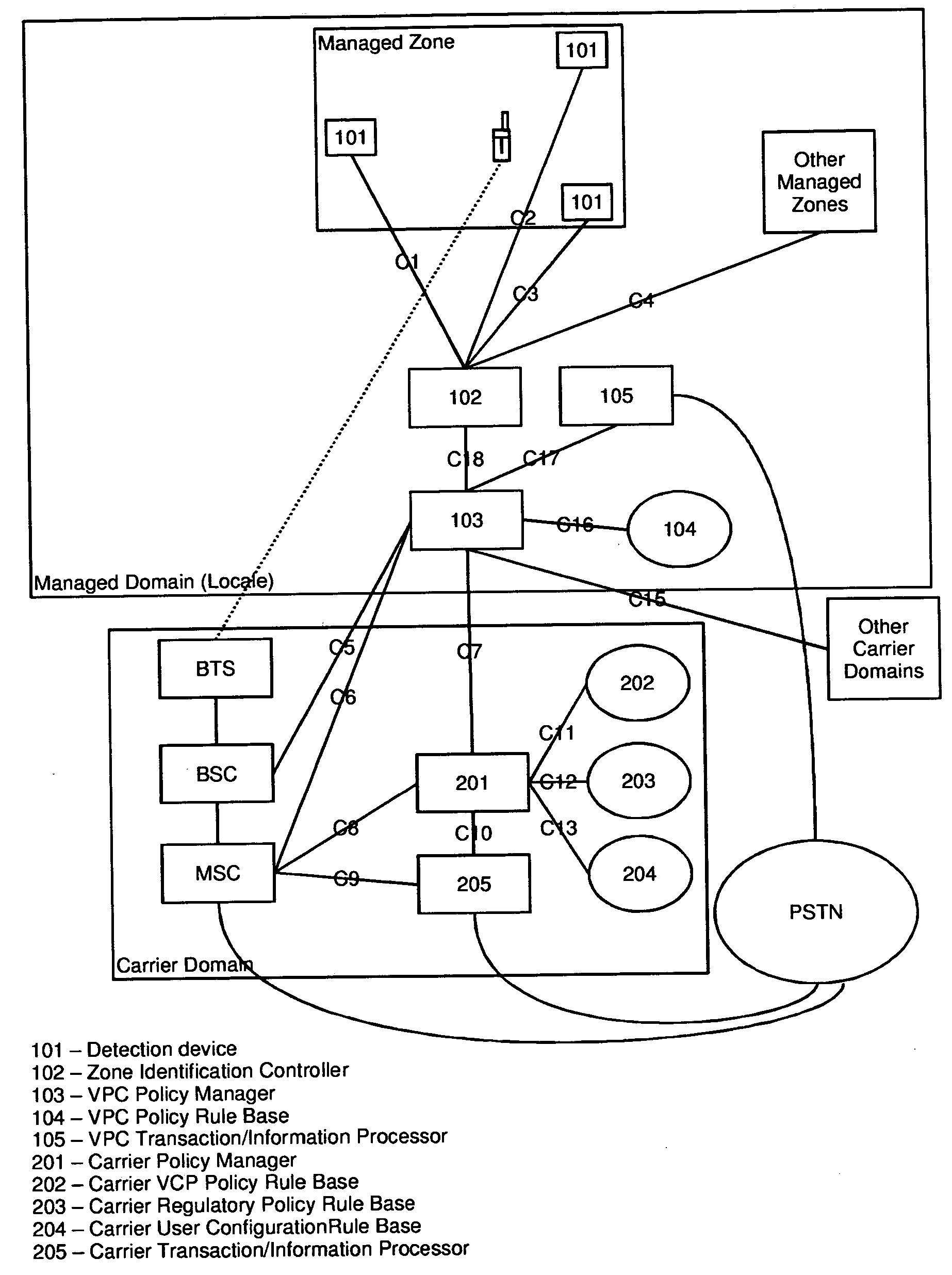

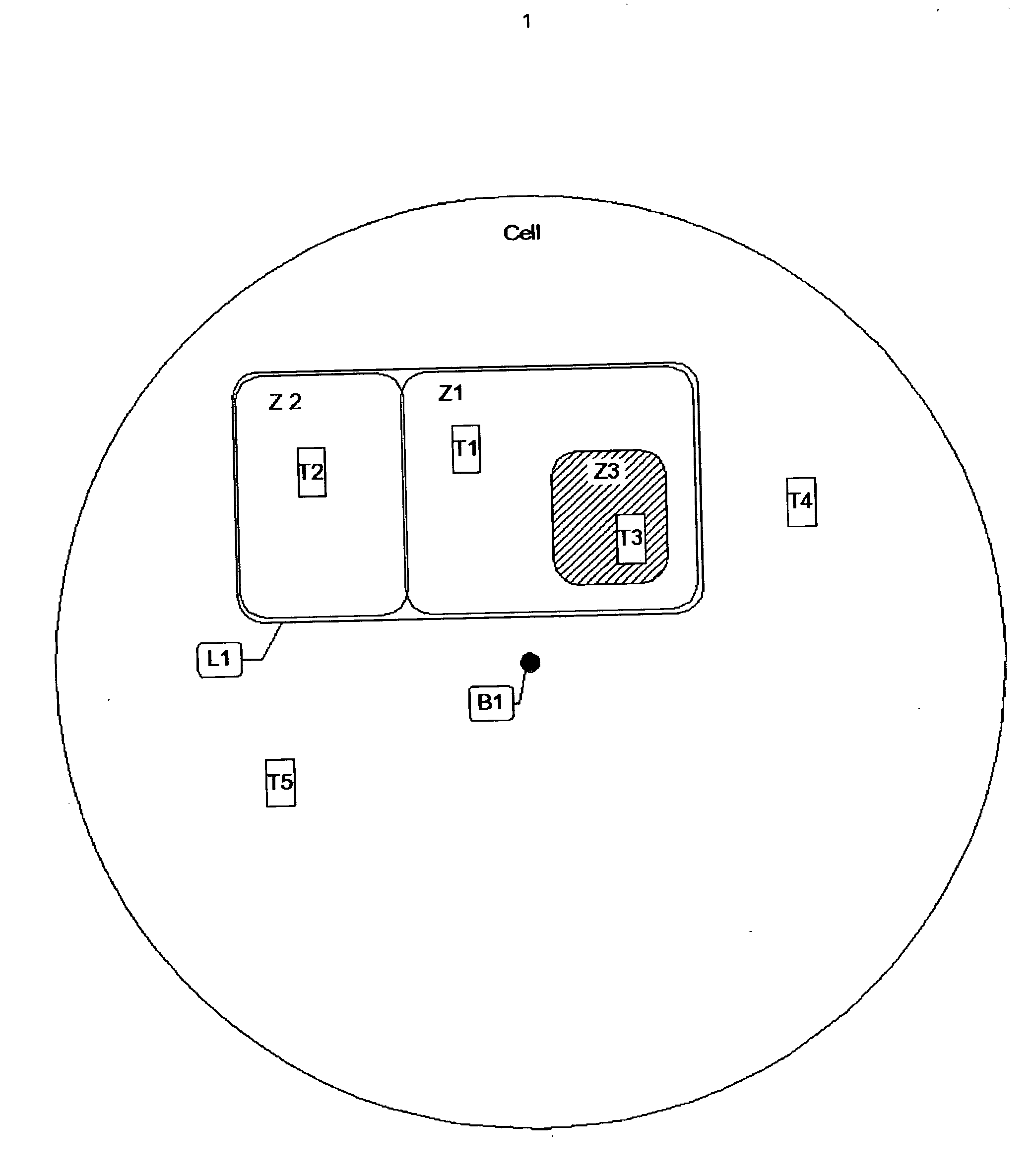

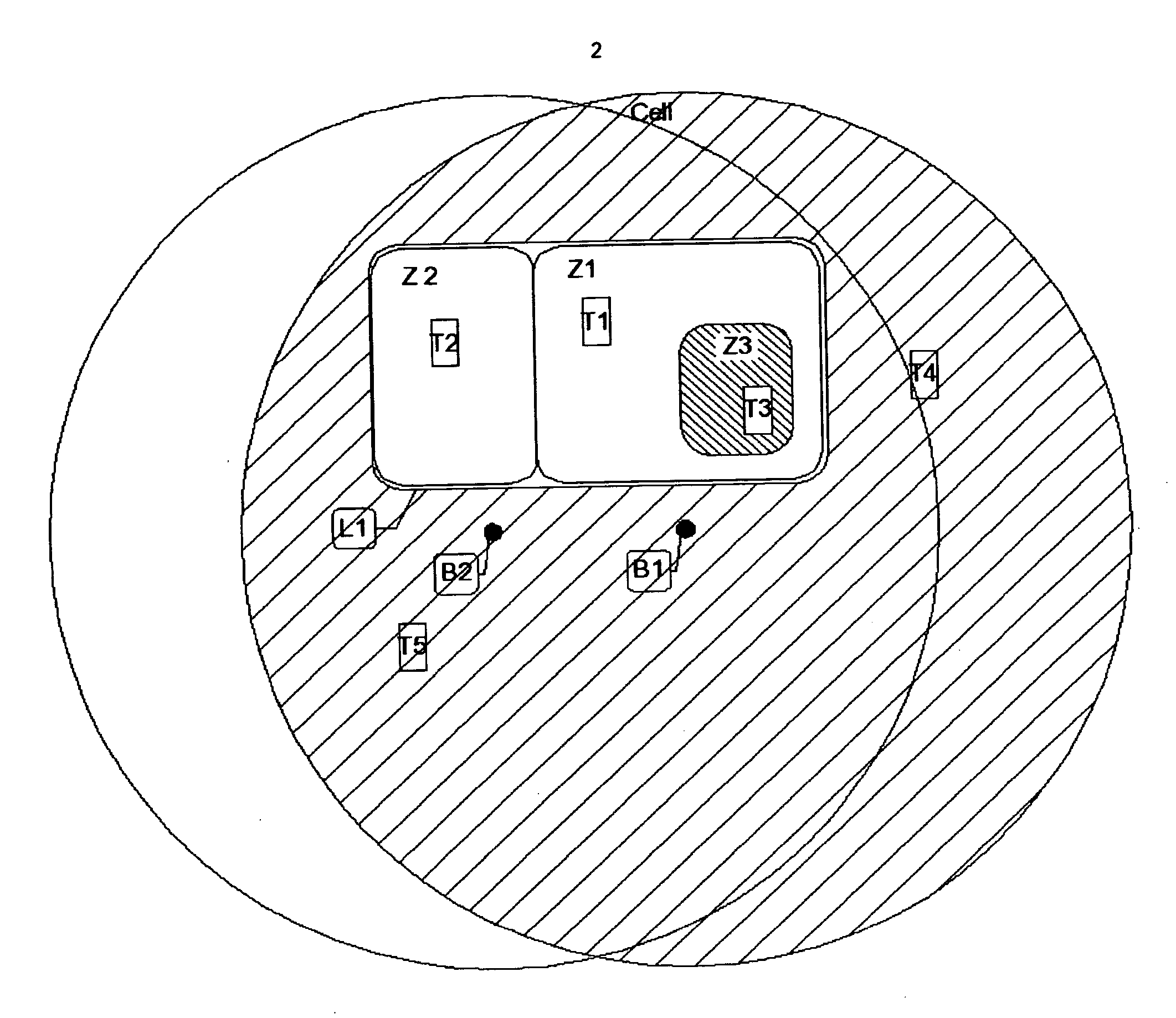

System and apparatus for managing access to wireless communication devices while present within a specified physical area

A method, system, apparatus, and computer program product is presented by which mobile communications services are managed, based upon the location of the mobile communications device within absolute three dimensional area or locale, as determined by the legal managers or owners of that locale. The locale may be subdivided into sub-areas or zones, which may be overlapping. The management services include: management of mobile devices such that specific features of the device may be enabled, disabled or otherwise actively manged while within the zone as well as the provision of alternative network services while the device is within the zone; transaction services provided to the user of the device due to its presence within the zone; information services provided to the user of the device due to its presence within the zone.

Owner:RANFORD PAUL BRIAN +5

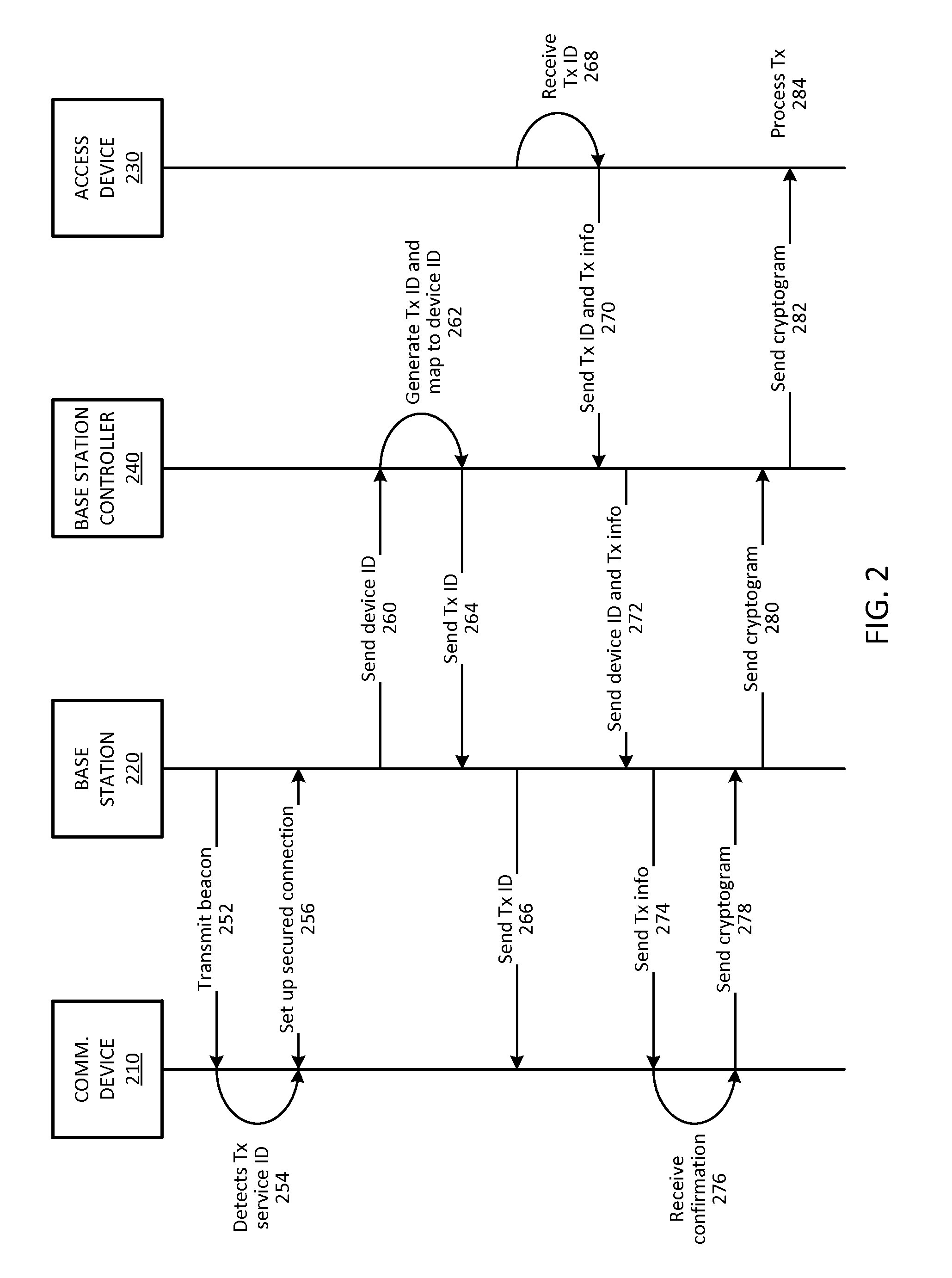

Midrange contactless transactions

Techniques for conducting a transaction in a midrange wireless communication system are described. The techniques may include detecting a beacon transmission from a midrange wireless base station, determining that the beacon transmission includes a transaction service identifier, and invoking a transaction application associated with the transaction service identifier. The techniques may also include receiving transaction information for a transaction associated with a transaction identifier mapped to the device identifier; and sending a transaction cryptogram from the transaction application to the midrange wireless base station to conduct the transaction.

Owner:VISA INT SERVICE ASSOC

Mobile transaction system and method

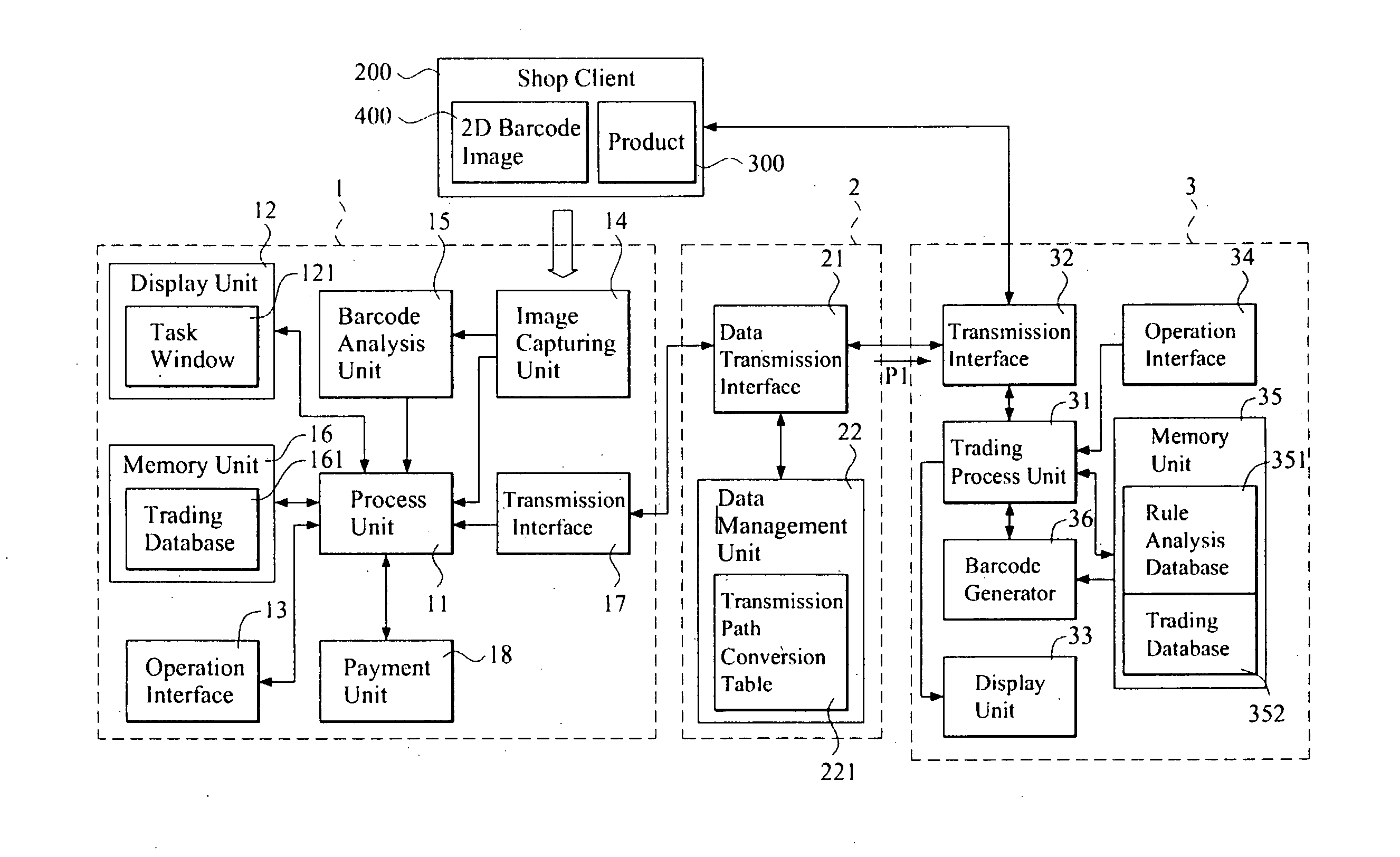

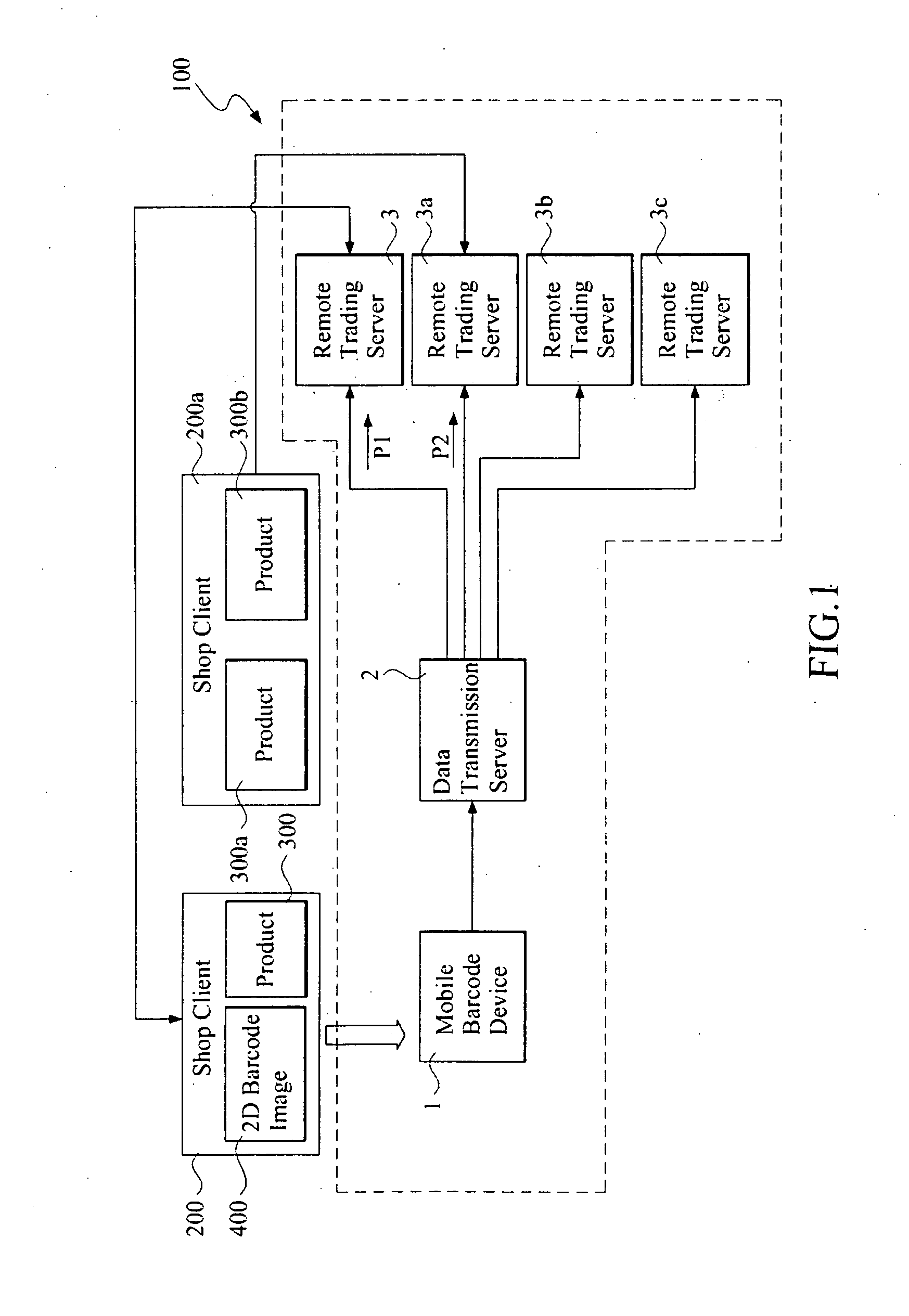

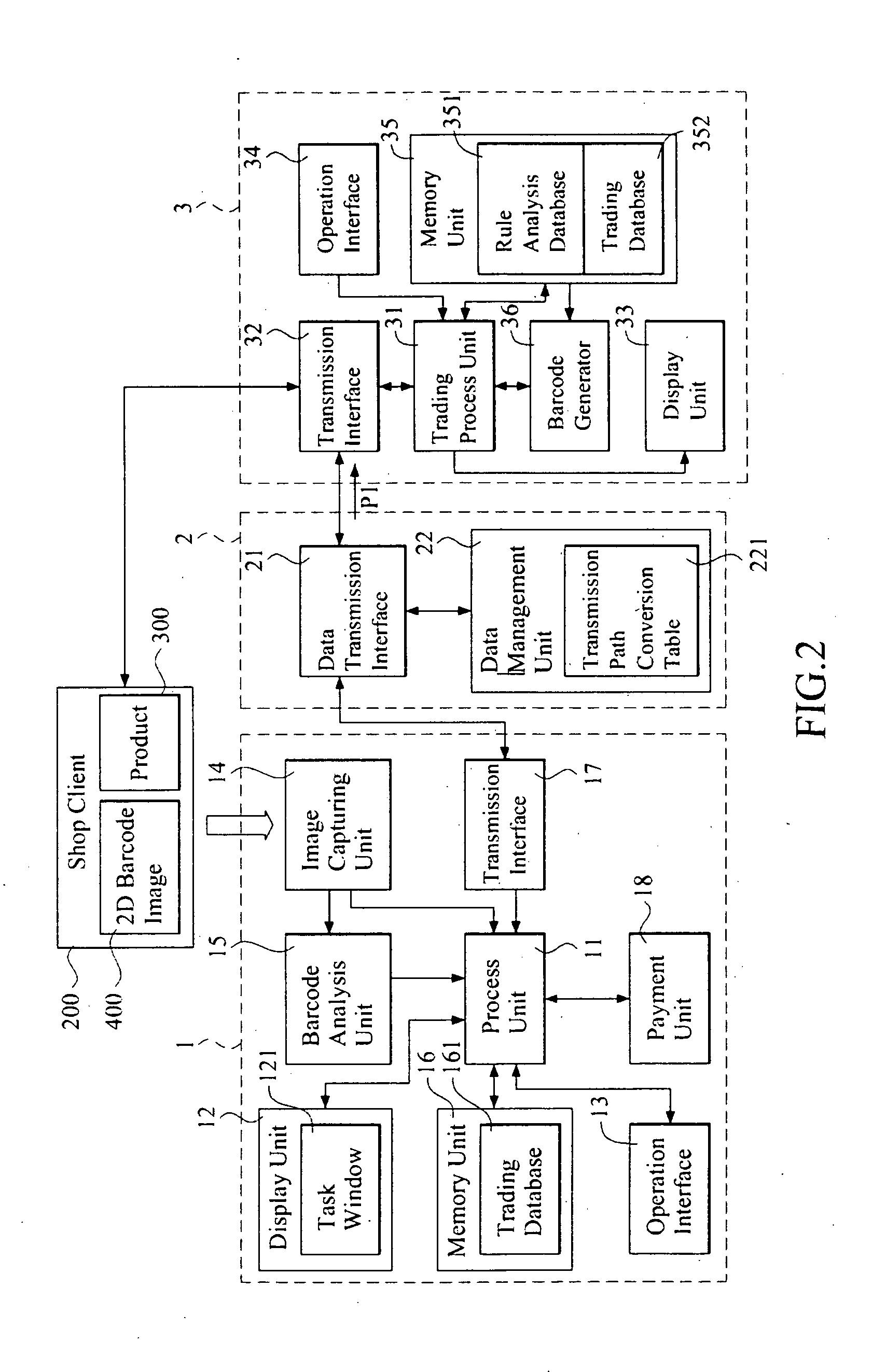

InactiveUS20100211506A1Reduce investmentImprove securityDigital data processing detailsPayment architecturePaymentTransaction service

A mobile transaction system and method are carried out by a plurality of remote trading servers, a mobile barcode trading device and a data transmission server. The remote trading server generates and transmits a two-dimensional barcode image to at least one store client to display thereon after a user selects at least one product from the store client. The mobile barcode trading device captures the two-dimensional barcode image, analyzes the two-dimensional barcode image to obtain an encrypted key data and a trade data, and generates an encrypted payment data by the encrypted key data after the user input a payment data. The encrypted payment data and the trade data are combined to generate an encrypted trade data being transmitted to at least one of a plurality of the remote trading servers via a data transmission server, so as to carry out a mobile transaction.

Owner:SIMPLEACT

Multifactor authentication with changing unique values

A method of authentication includes the steps of providing a transaction service provider having a secure server; providing a user; requesting access authorization to the server of the service provider by the user, the server storing a set of use parameters obtained from the authorization access request, the use parameters including at least several prior location coordinates, methods of access, transaction information and access hardware used during the authentication to be used by the transaction service provider in subsequent requests by the user to access the server, the use parameters used in the authentication to be continually updated with the most recent data.

Owner:IBM CORP

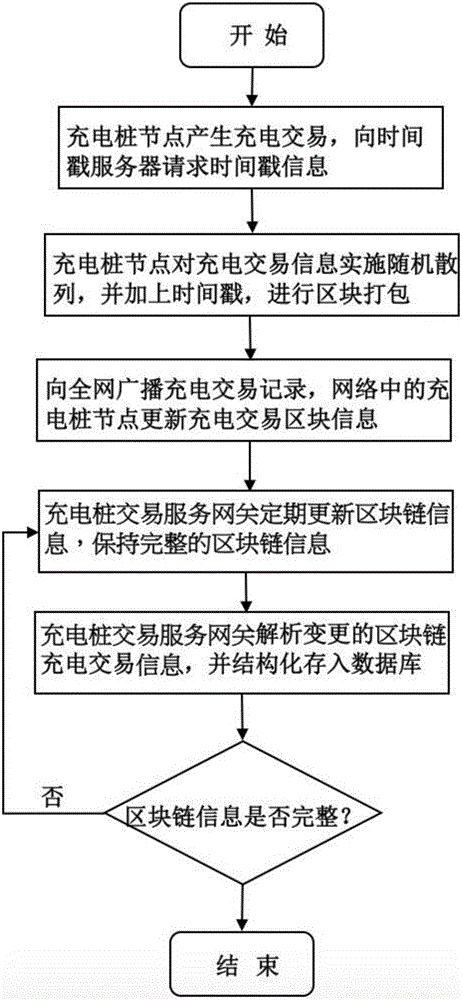

Block chain based charging pile charging transaction communication method and device

ActiveCN105912618AApparatus for hiring articlesSpecial data processing applicationsTimestampTransaction service

The invention relates to a block chain based charging pile charging transaction communication method which overcomes the defects of the prior art. The technical scheme is that: a first step, a charging pile node generates a charging transaction, and the charging pile node requests a timestamp server for timestamp information; a second step, the charging pile node performs random hashing on charging transaction information, and adds a timestamp to the charging transaction information and performs block packaging; a third step, the charging pile node having the transaction broadcasts the charging transaction information to the whole network of a charging pile network, and charging pile nodes in the charging pile network update charging transaction block information; a fourth step, a charging pile transaction service gateway regularly updates block chain information to keep the complete block chain information; a fifth step, the charging pile transaction service gateway analyzes the changed block chain charging transaction information, and the block chain charging action information is structuralized and stored in a database; and a sixth step, the charging pile transaction service gateway determines if the block chain charging transaction information is complete or not, and the fourth step is executed again if not.

Owner:ZHEJIANG WANMA NEW ENERGY

Anonymous transaction system

An Anonymous Transaction Service (ATS) solves or alleviates the problems outlined above. The ATS provides anonymous, automated, risk-based differential pricing that allows consumers to receive offers from multiple suppliers with only a single credit report. The ATS facilitates any offer between a supplier and consumer that first requires an evaluation of the risk associated with making the offer. The ATS can be used for any product or service, such as credit cards, home mortgages, automobile loans, appliance loans, debt consolidation loans, insurance products, advertising and dating services, to name only a few.

Owner:NEXTWORTH SOLUTIONS

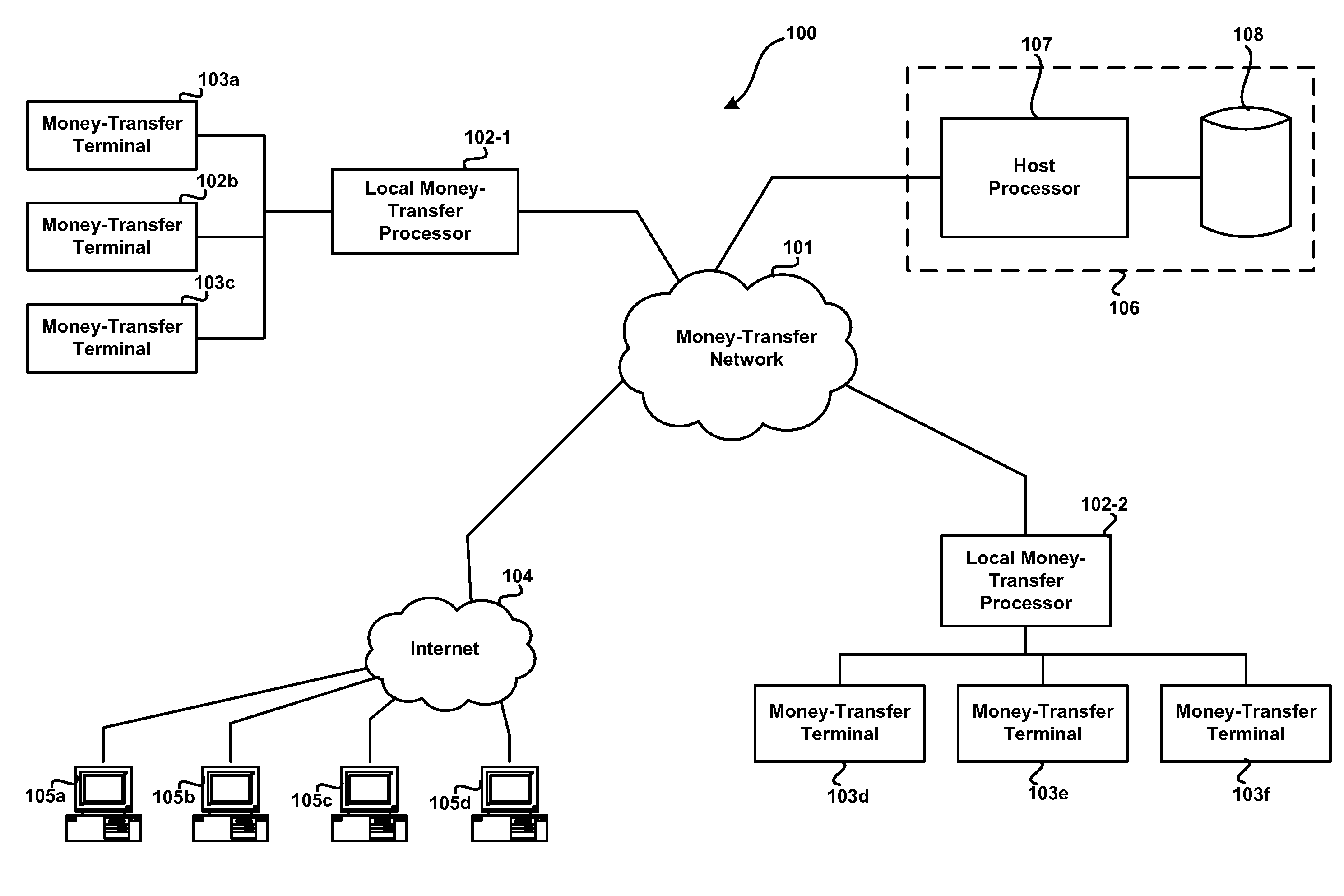

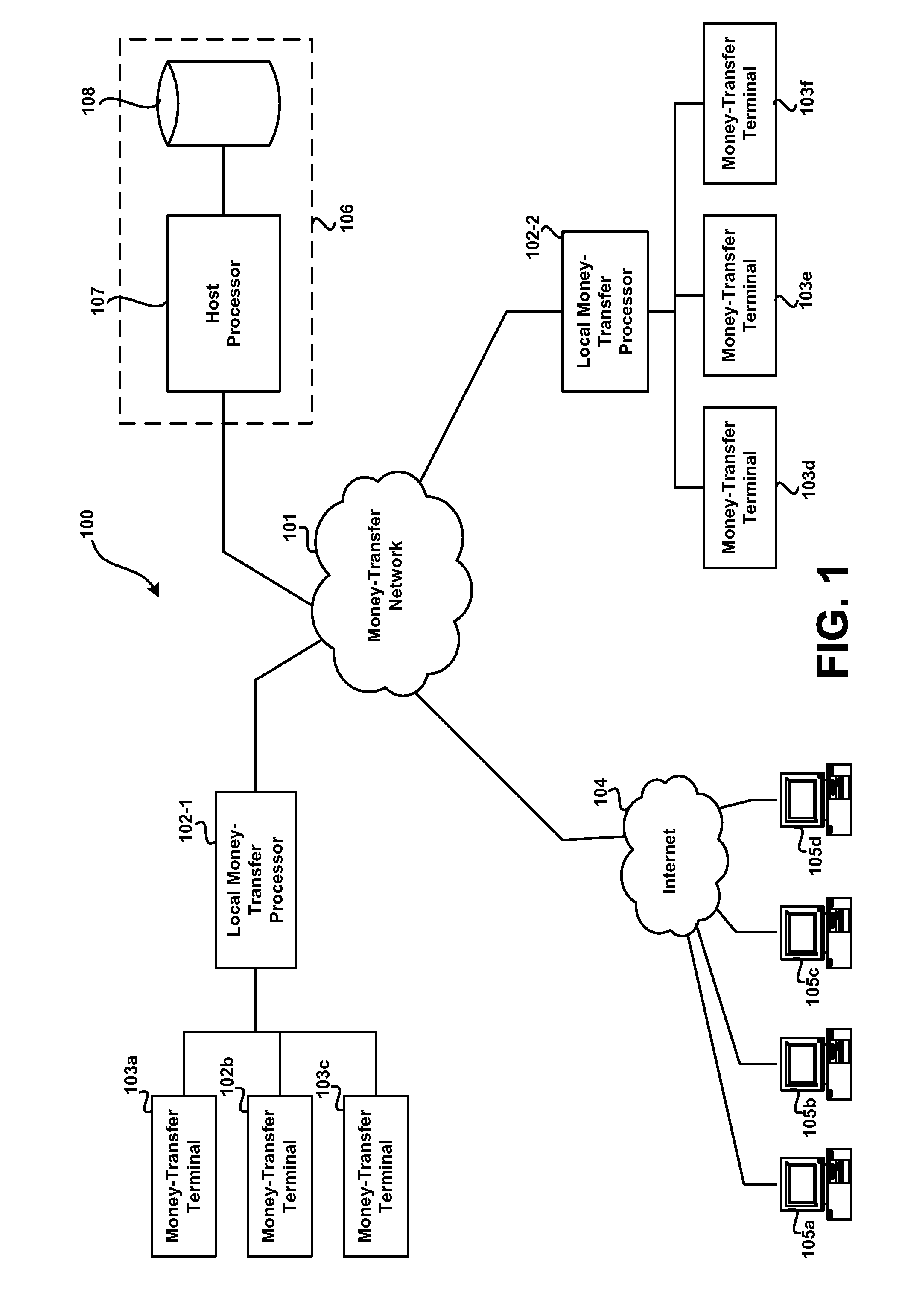

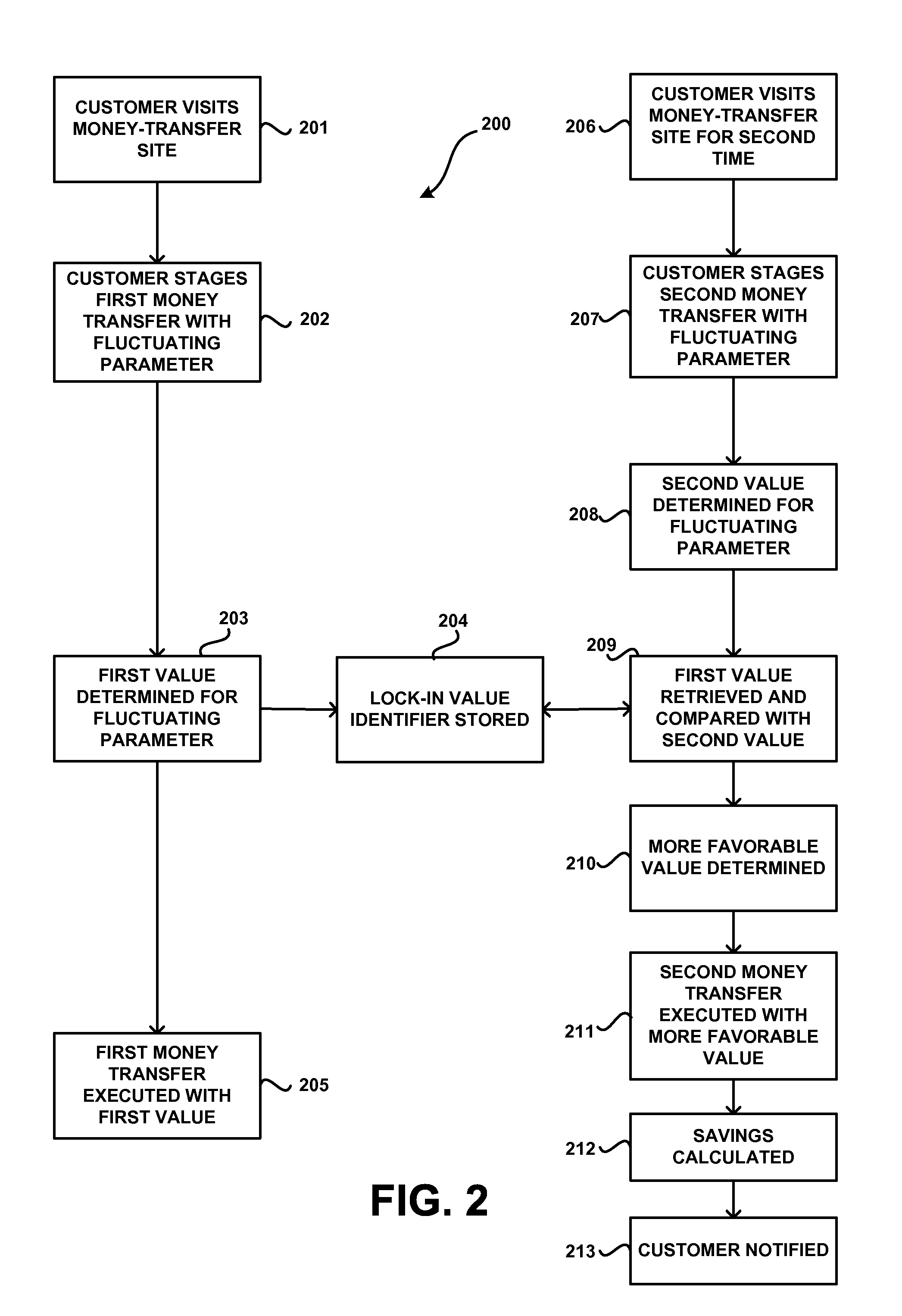

Methods and systems for executing a plurality of money transfers having a fluctuating parameter

Systems and methods are provided for executing a plurality of money transfers, at least one term of which is dependent on the value of a fluctuating parameter, for example a currency exchange rate or the amount of a transaction service fee. The customer may stage a first money transfer at a money-transfer system and a first value of the fluctuating parameter may be determined by a host processor. The first money transfer may then be executed by the money-transfer system using the first value of the fluctuating parameter and a unique lock-in value identifier may be stored in the host processor's memory that associates the first value of the fluctuating parameter with the customer.

Owner:THE WESTERN UNION CO

Cash dispensing automated transaction machine and method

InactiveUS20050121513A1Firmly connectedAmount of timeComplete banking machinesFinanceTransaction serviceCard reader

A system for connecting transaction services to an ATM (10, 500) that includes a network (20). A user interface service (12) and a lookup service (22) are in operative connection with the network. Transaction services such as a printer service (16), card reader service (18), and cash dispenser service (14) are also in operative connection with the network. These transaction services are operative to register with the lookup service and to upload a service proxy to the lookup service. The user interface service is operative to locate transaction services on the network by invoking a remote lookup method on the lookup service. The lookup service is operative to return service proxies that match the type of service that is required. The user interface service is further operative to invoke methods of the service proxies that remotely control the functionality of the transaction services on the network. The user interface service is further operative to register events with the service proxies for notification when certain events on the services occur.

Owner:DIEBOLD NIXDORF

Method and software for testing and performance monitoring

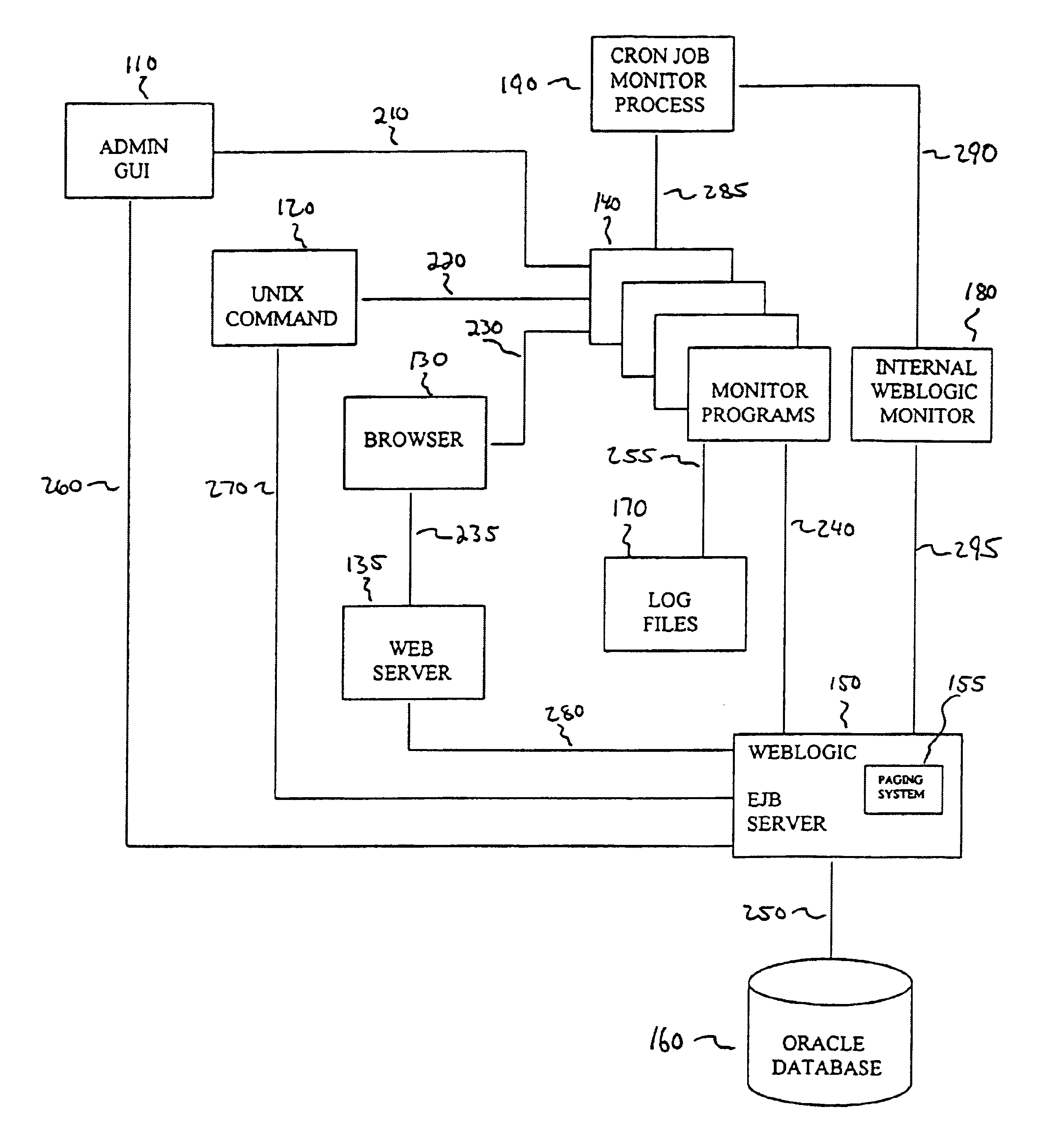

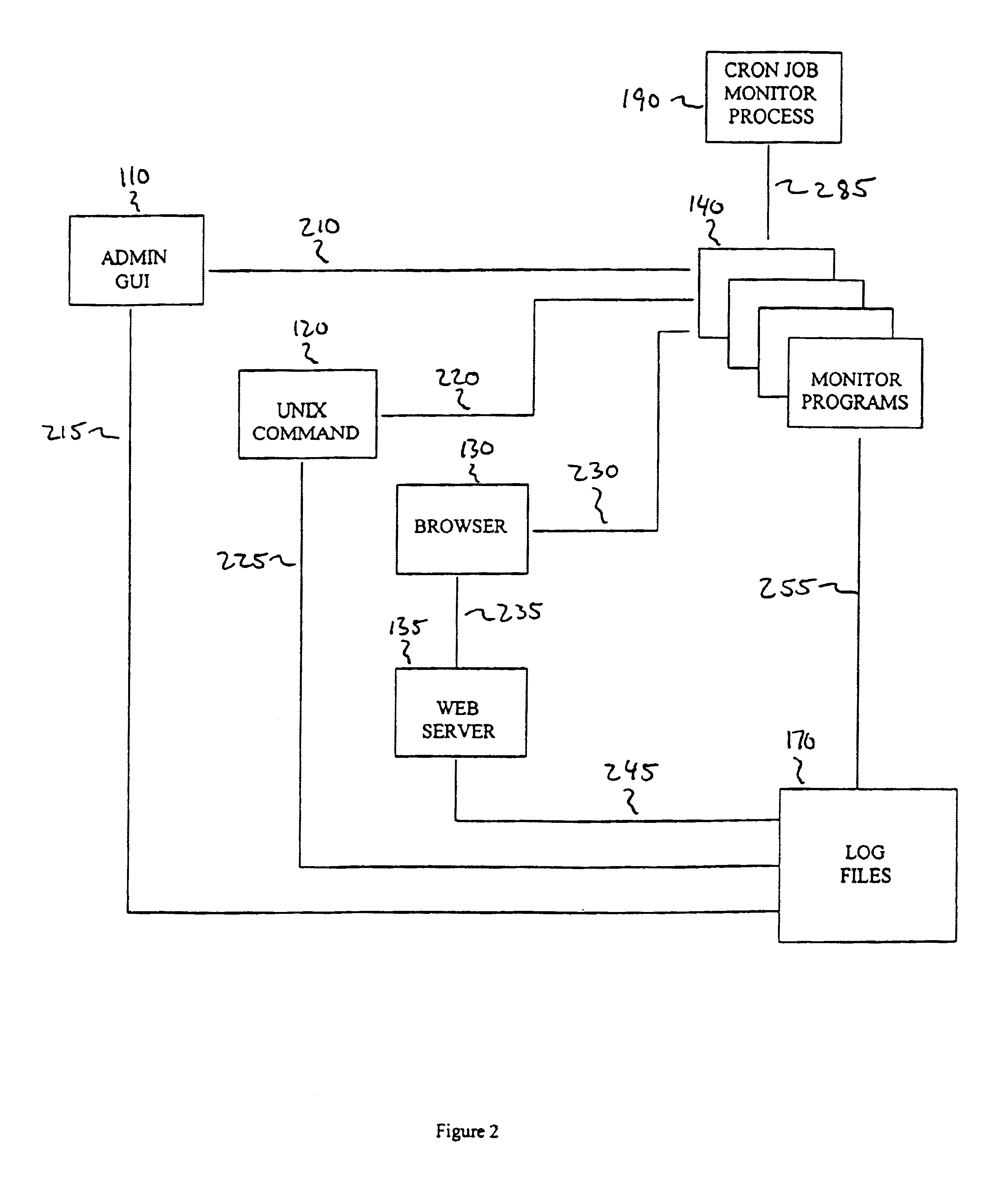

InactiveUS6874099B1Digital computer detailsHardware monitoringTransaction servicePublish–subscribe pattern

One embodiment of the present invention provides a method for testing and monitoring software applications such as naming services, messaging services, publish / subscribe services, authentication / authorization services, transaction services, and the like. The method involves testing multiple elements of the application so as to ease trouble-shooting in the event of failure of some element of the application. A preferred embodiment also gathers performance statistics which can prove useful in analyzing loads and efficiencies of various applications and processes or elements within an application.

Owner:T MOBILE INNOVATIONS LLC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com