Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

507 results about "Money transfer" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Authenticating Wireless Person-to-Person Money Transfers

InactiveUS20070255662A1Facilitates manualFacilitates automated load functionalityDebit schemesLock-out/secrecy provisionWireless transmissionComputer science

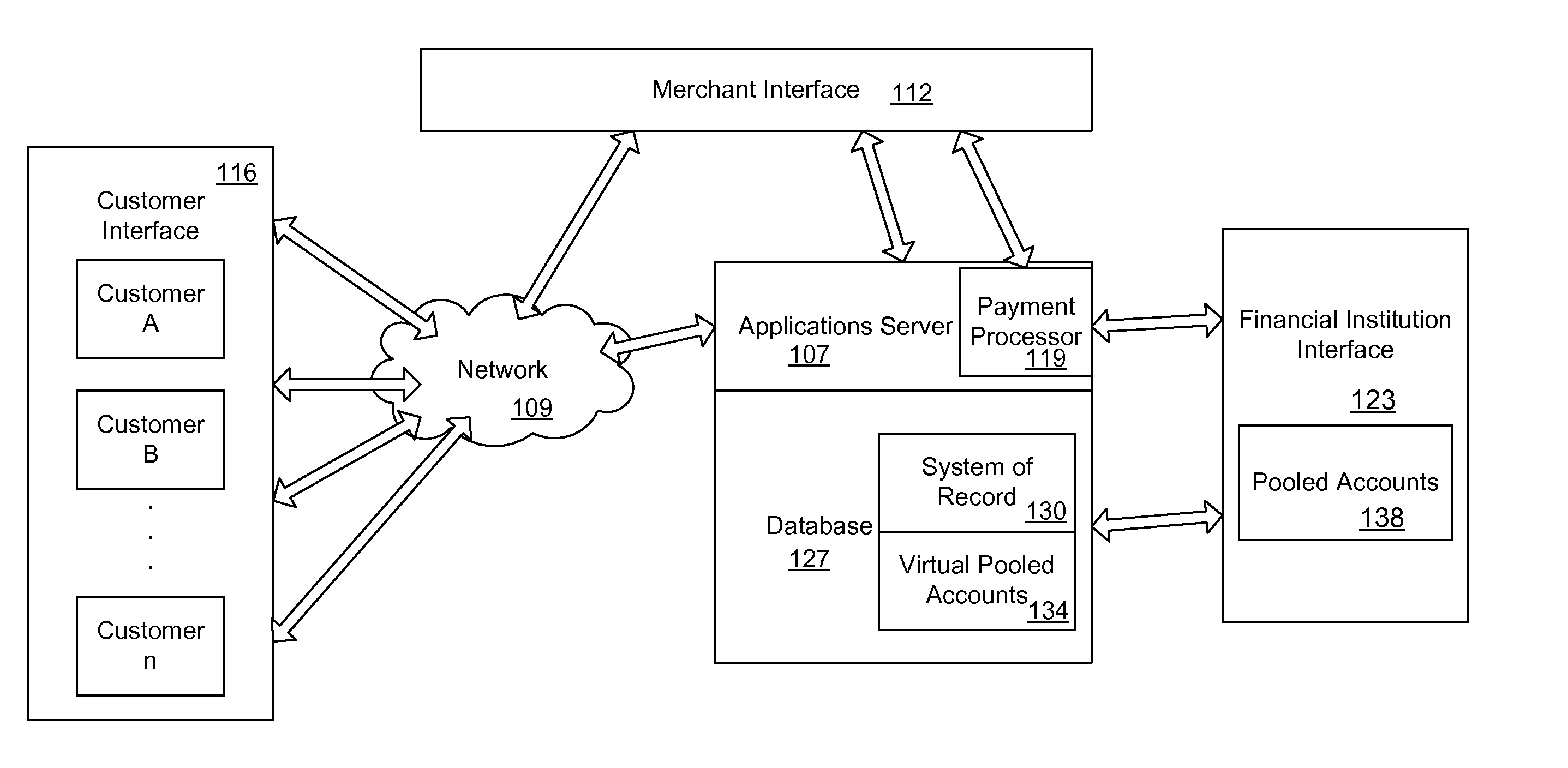

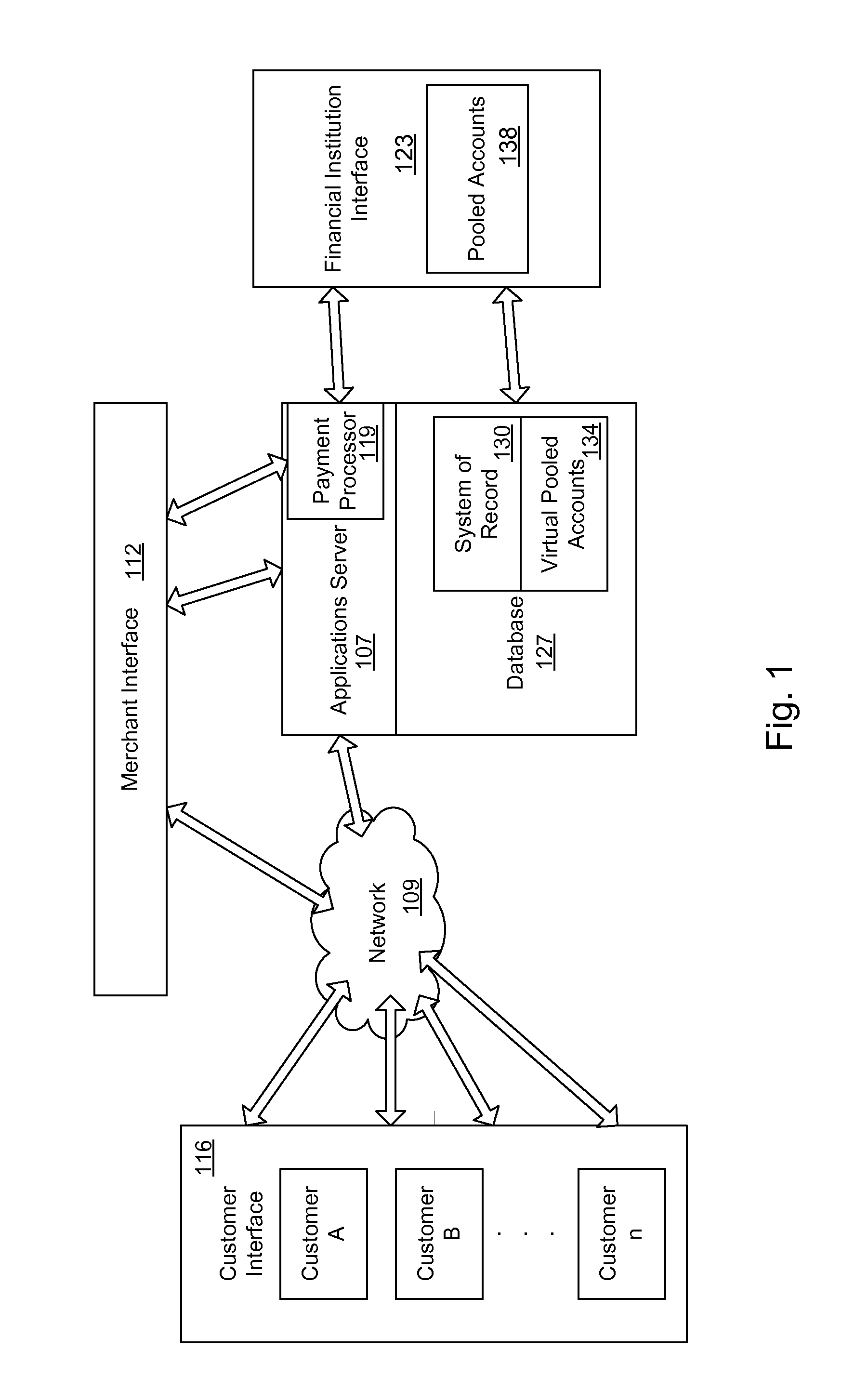

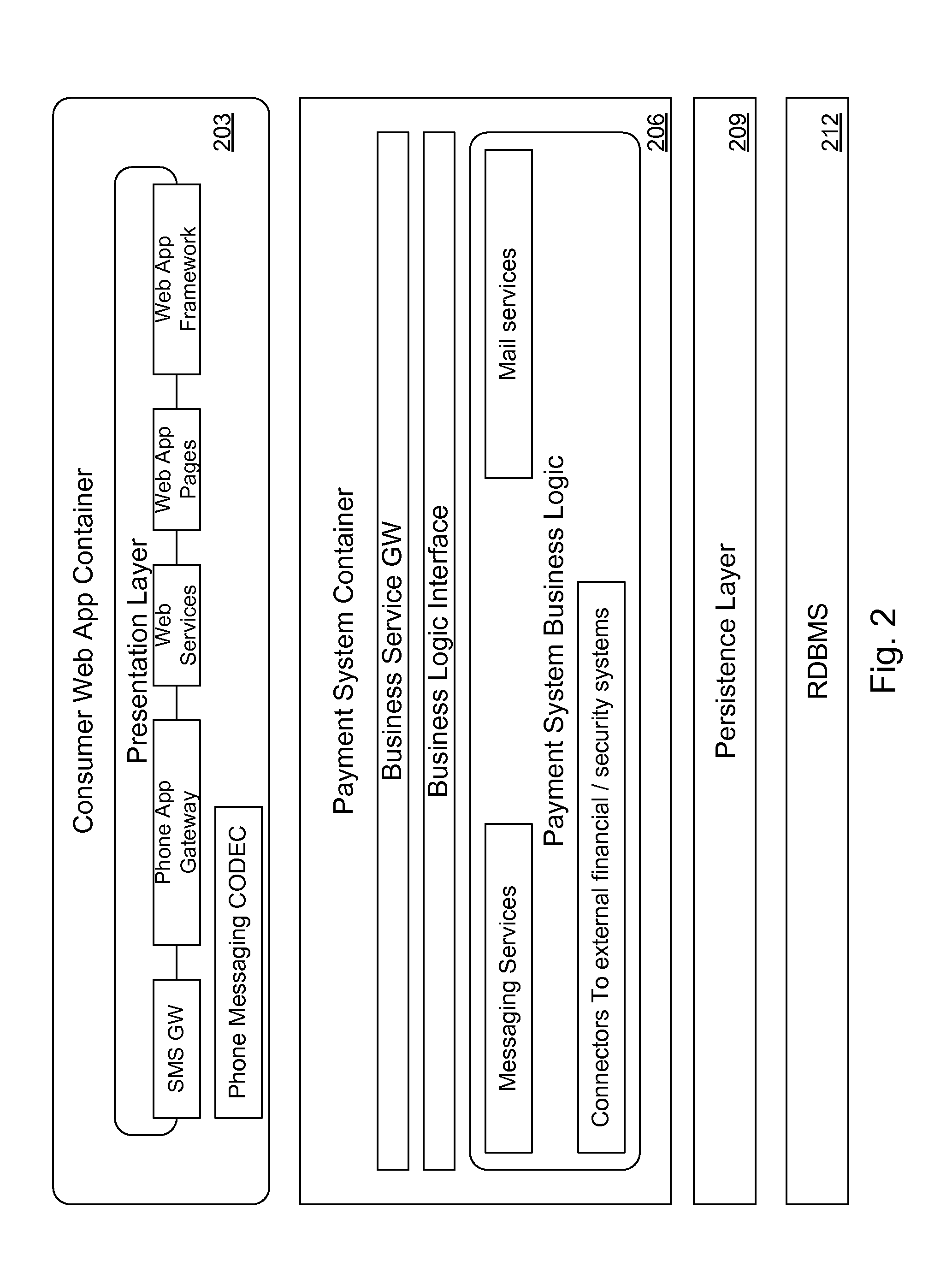

A technique is used to ensure the authenticity of a wireless transmission source which is requesting a transaction to be performed by a system. The transaction may be a person-to-person money transfer or other value exchange transaction. The wireless transmission source may be a mobile phone or other similar device. The wireless transmission source transmits a key with the transaction request. The system will determine the authenticity of the transmission based on the transmitted key. If the transmission is determined to be authentic, the transaction will be acted upon. Various approaches for determining authenticity are discussed. The technique may also be used to prevent acting upon duplicate transmissions.

Owner:OBOPAY MOBILE TECH INDIA PTE LTD

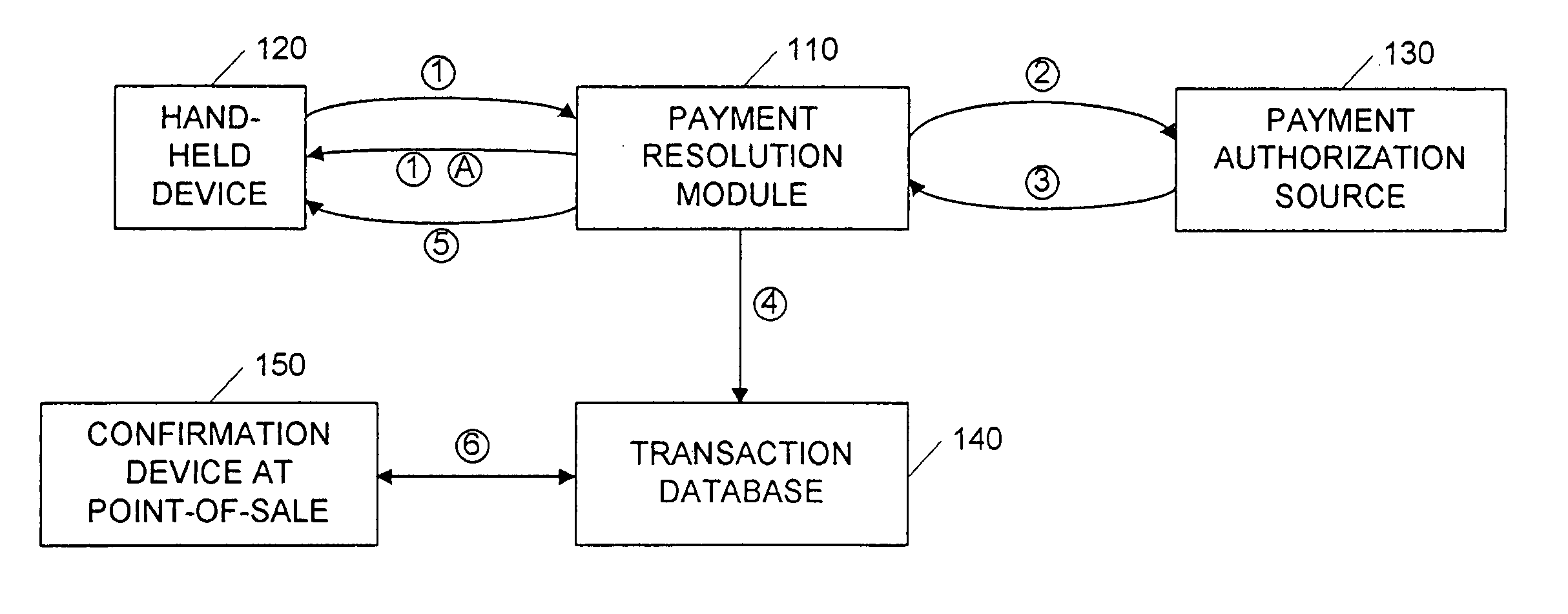

Secure money transfer between hand-held devices

A payment resolution module is configured to communicate with hand-held devices (such as mobile phones, PDA's, or computers) to allow secure transfer of funds between financial accounts associated with each of the hand-held devices. A user of a paying device may be identified as the owner of the device either by having the option to enter a personal identification code, or by using a biometric to identify himself, for example. Accordingly, only an authorized user of the hand-held device may use the hand-held device to transfer funds. A user of the recipient device may be identified by an identification code or a telephone number, for example, which is associated with a recipient financial account. After the payment resolution module receives authorization for a payment request to the recipient account, a payment transfer module transmits the requested amount from a payment source associated with the identified owner of the paying device to the recipient account.

Owner:XILIDEV

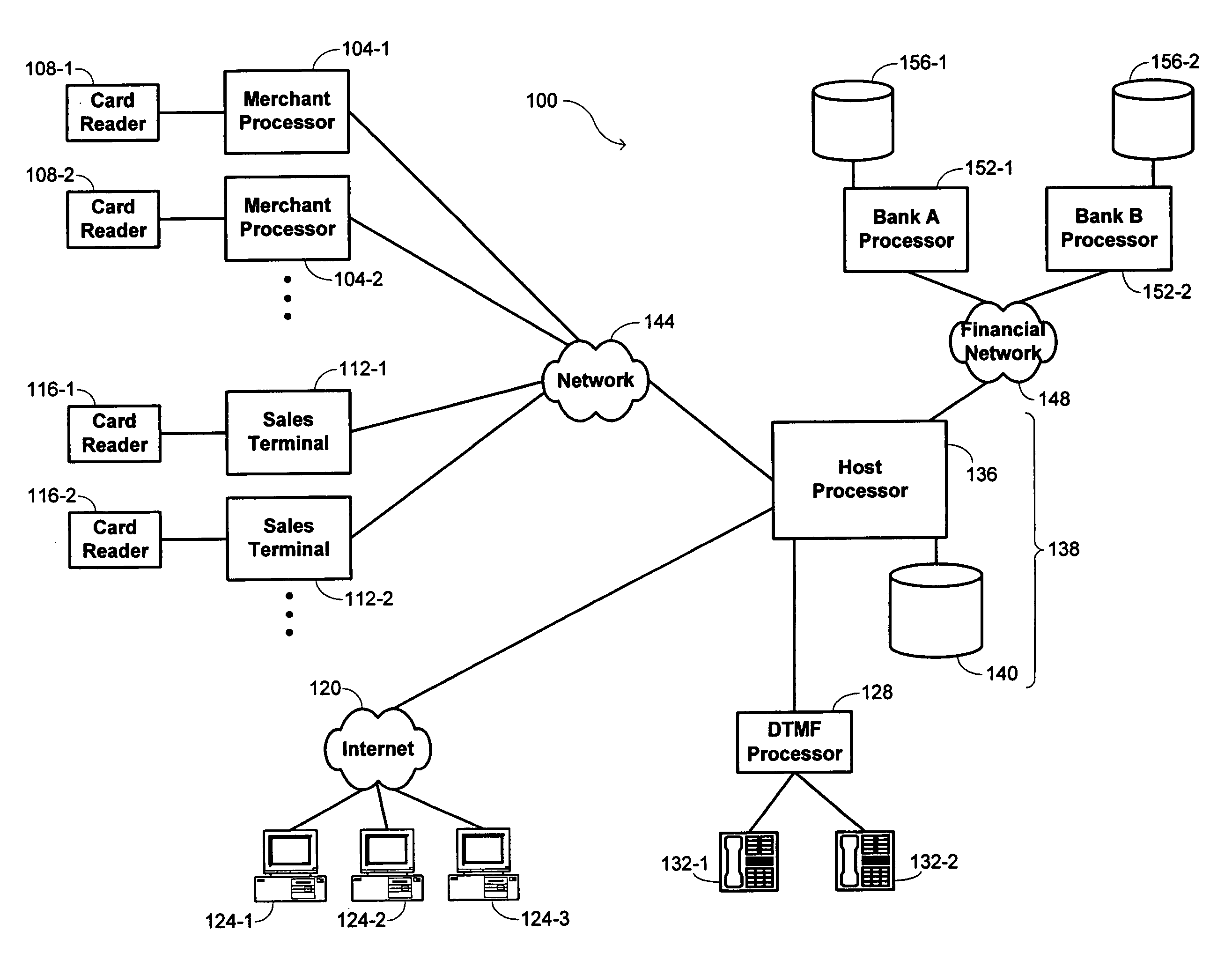

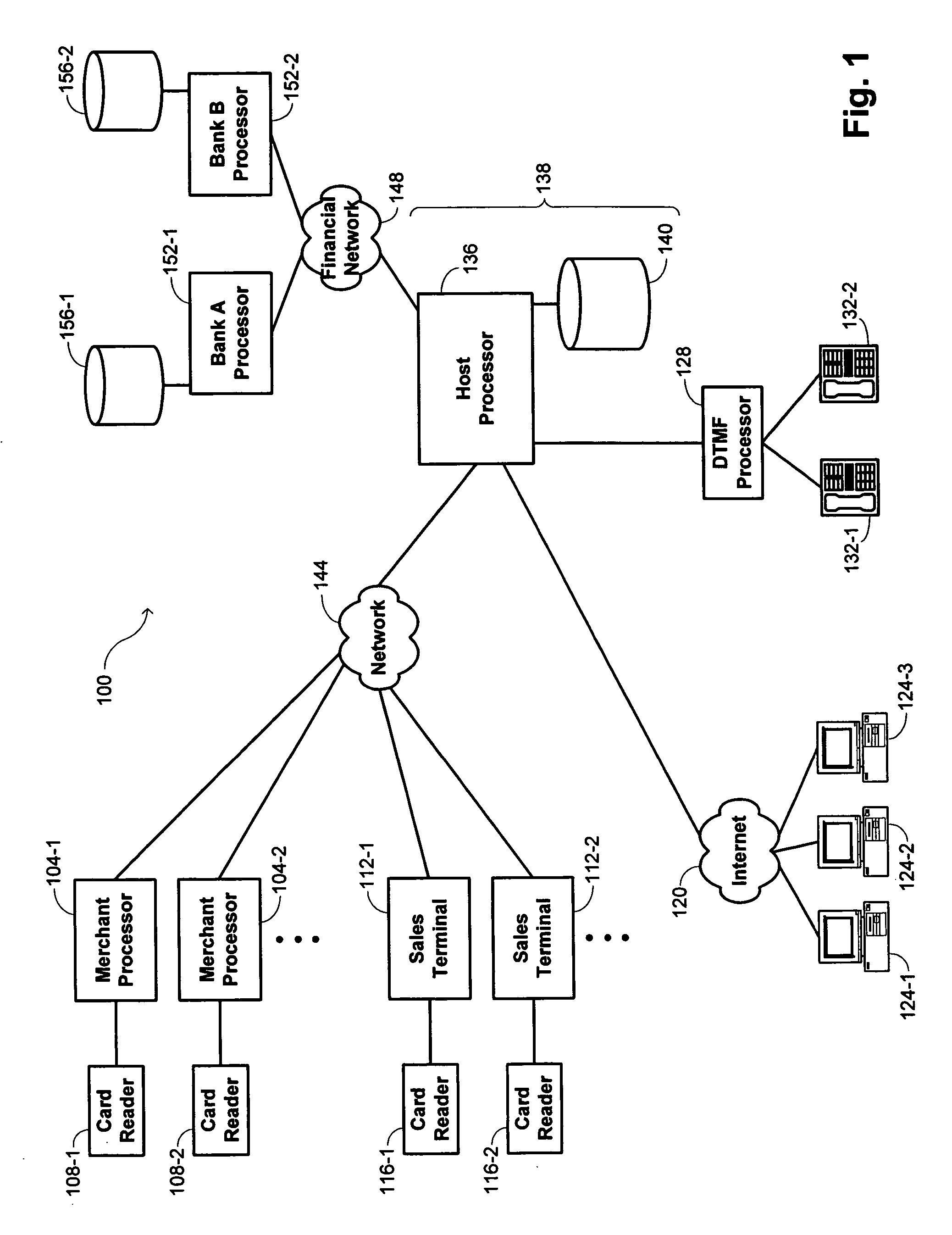

System and method for performing money transfer transaction using TCP/IP

InactiveUS6502747B1Low costShorten the timeComplete banking machinesFinanceInternet protocol suiteProtocol for Carrying Authentication for Network Access

A method of performing a money transfer transaction through a financial services institution includes receiving information regarding the transaction on a first computer of the financial services institution from a first electronic device using the Transmission Control Protocol / Internet Protocol suite (TCP / IP). The method may also include establishing a T1 connection between the first computer and the first electronic device. A system for performing a money transfer transaction using TCP / IP is also disclosed.

Owner:THE WESTERN UNION CO

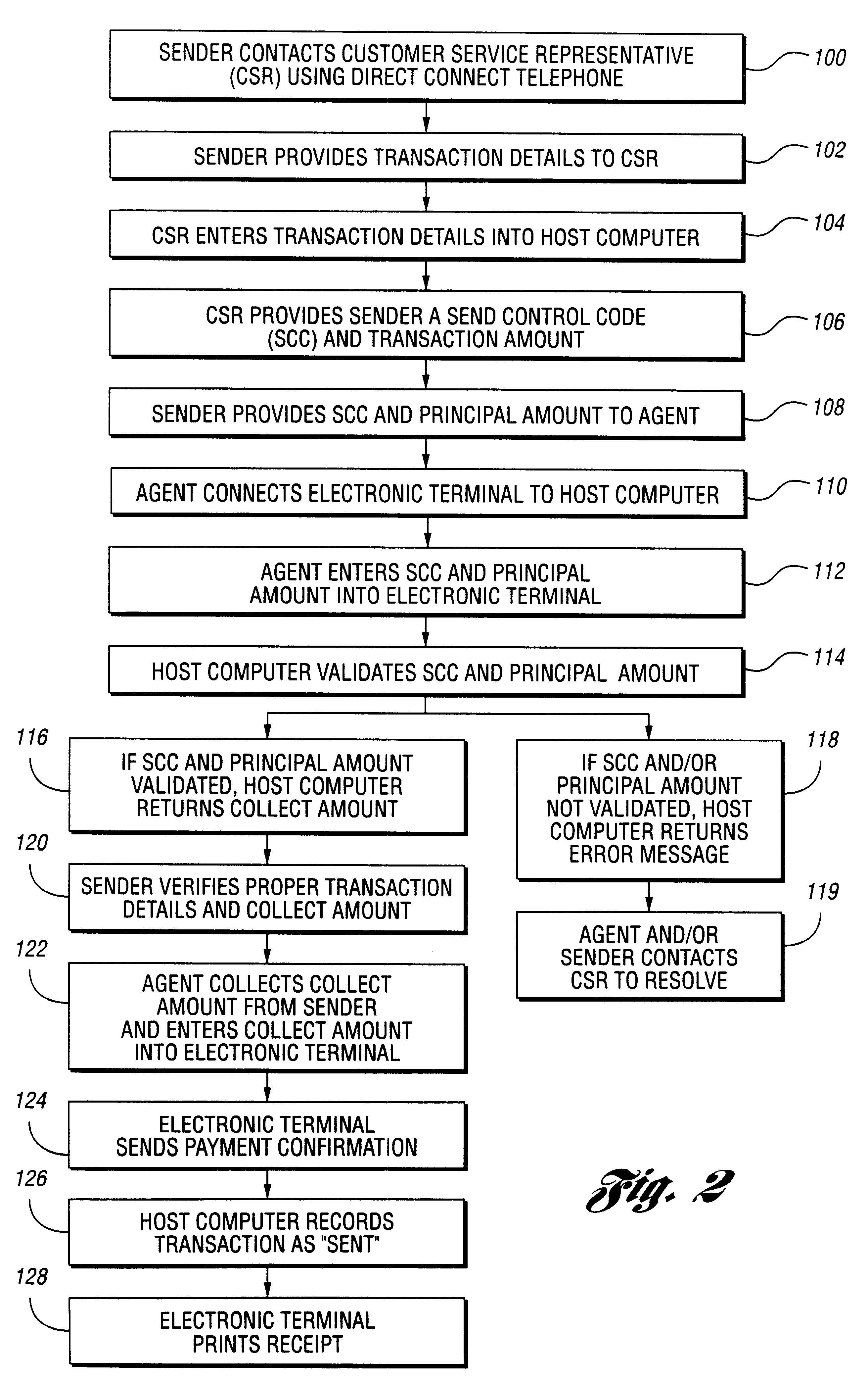

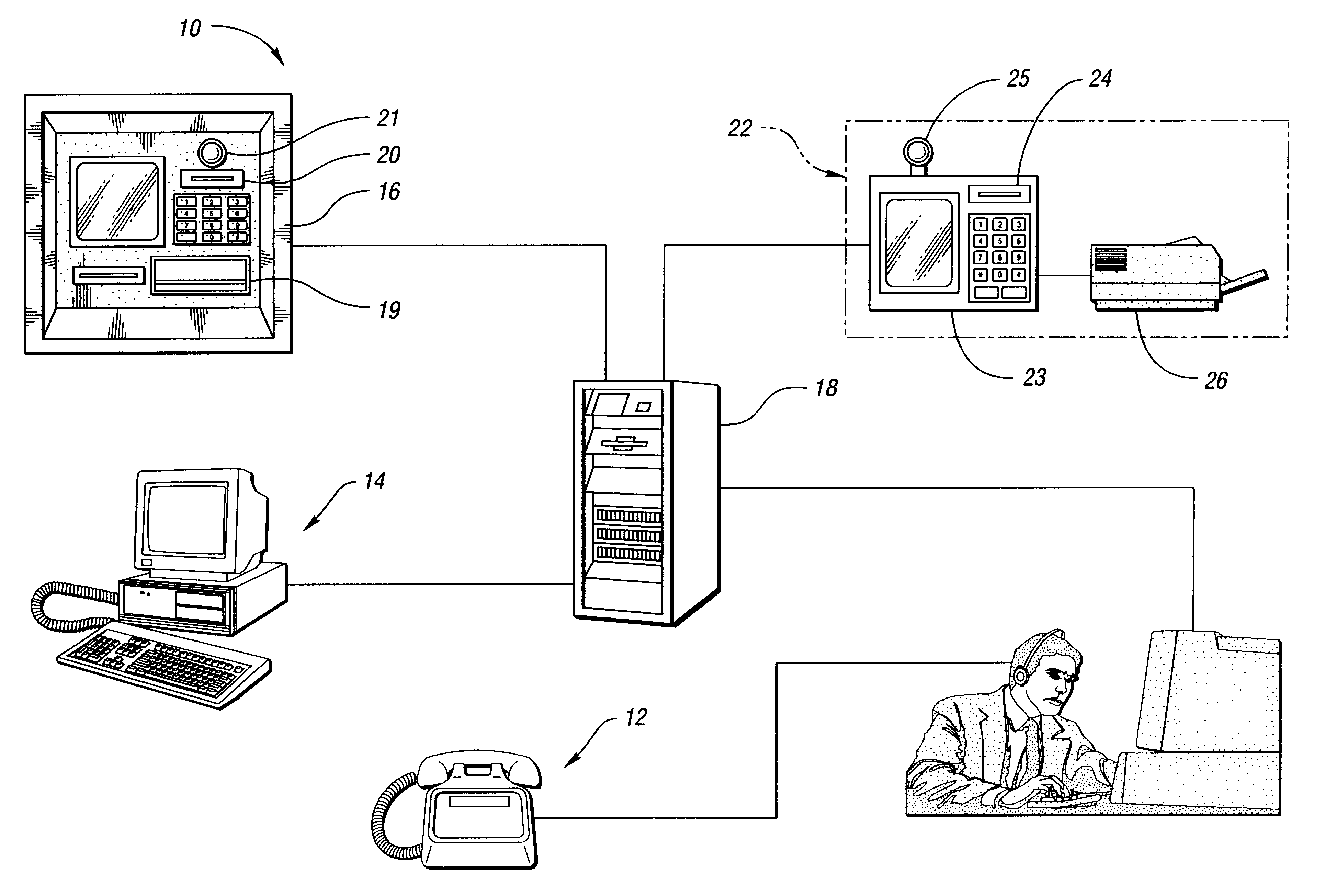

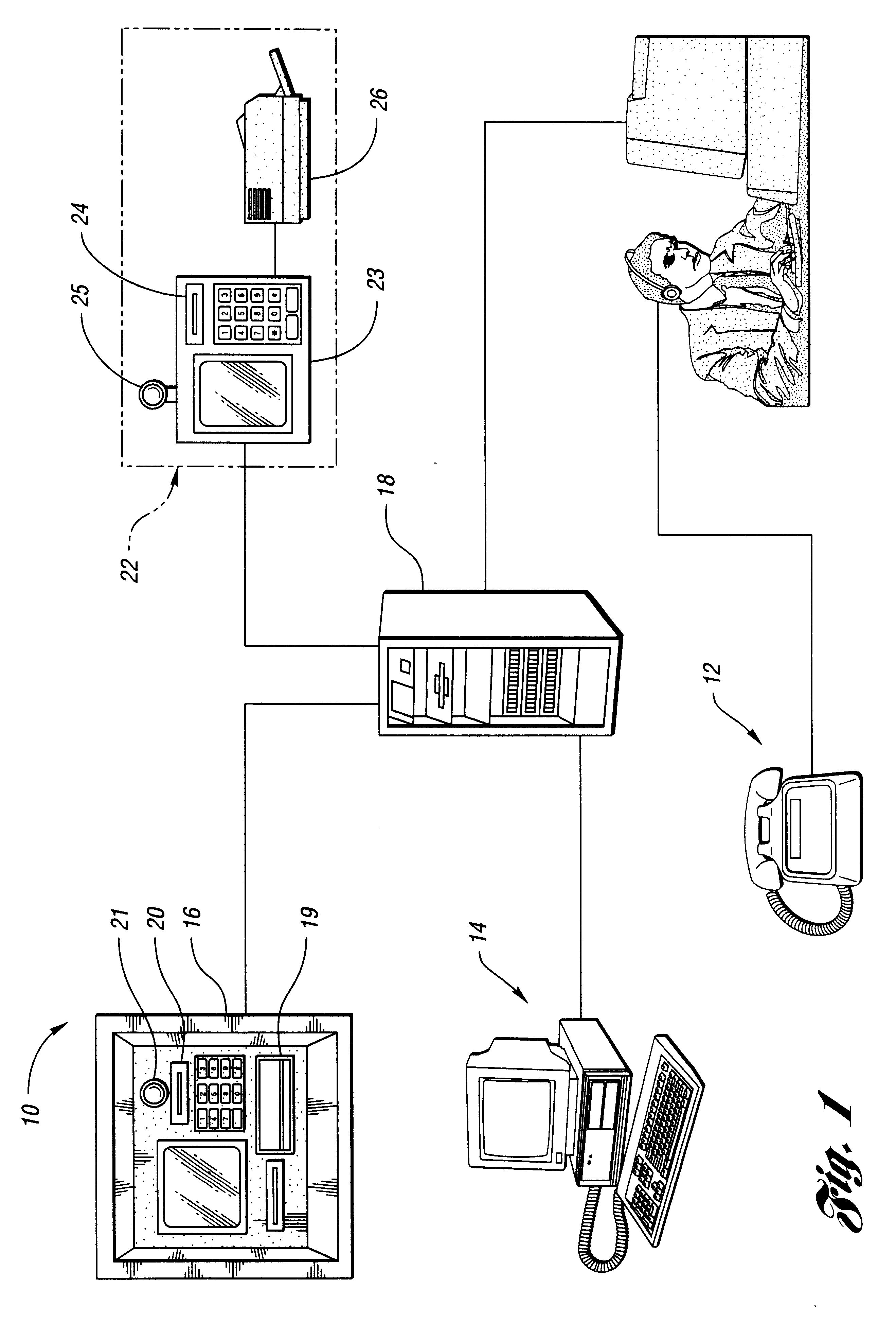

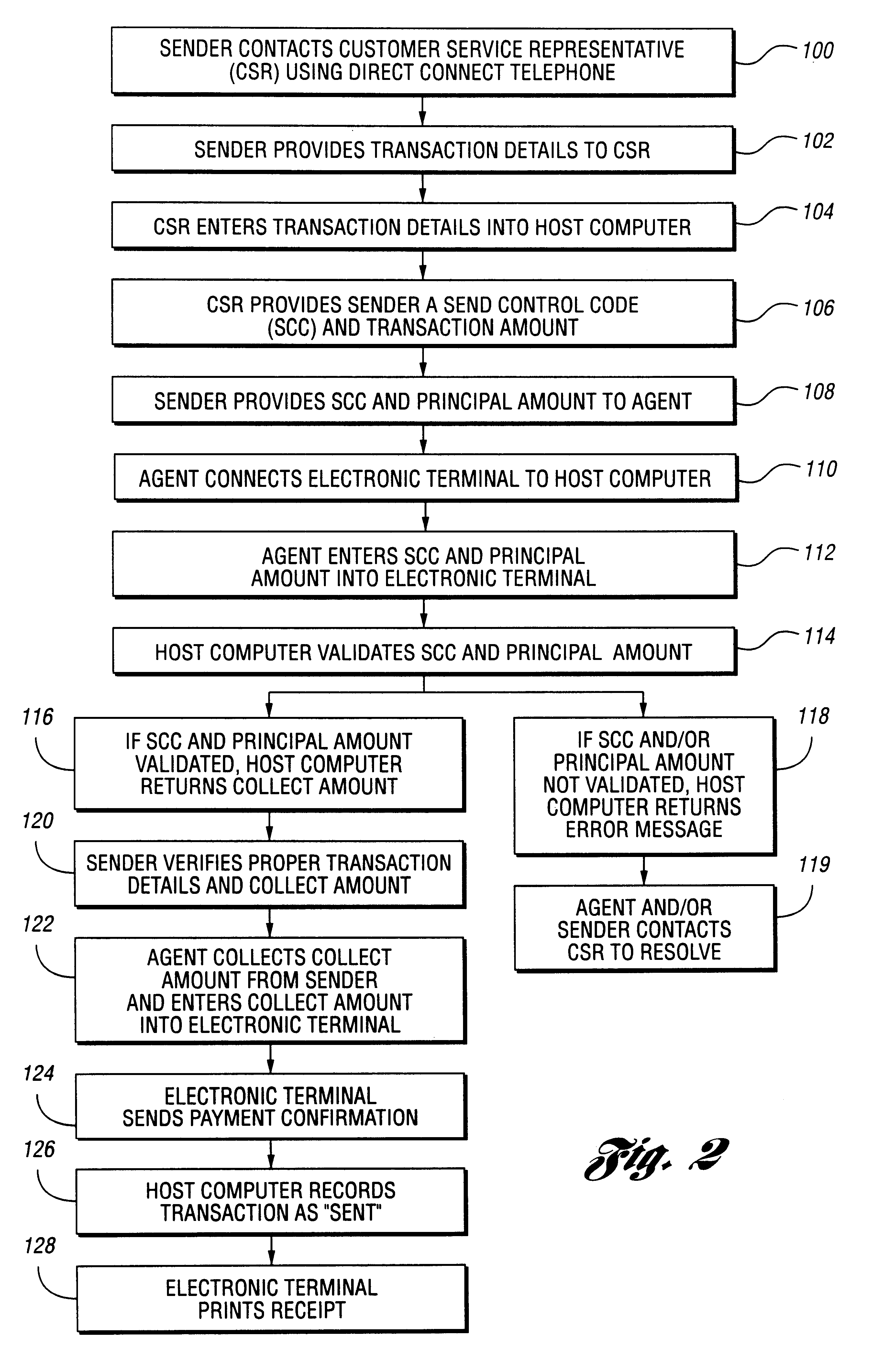

Method and system for performing money transfer transactions

InactiveUS6488203B1Shorten transaction timeImprove accuracyComplete banking machinesFinanceComputer scienceDatabase

A method of performing a send money transfer transaction through a financial services institution includes storing transaction details on a data base, wherein the transaction details include a desired amount of money to be sent; establishing a code that corresponds to the transaction details stored on the data base; entering the code into an electronic transaction fulfillment device in communication with the data base to retrieve the transaction details from the data base; and determining a collect amount based on the transaction details. A system for performing a send money transfer transaction is also disclosed.

Owner:THE WESTERN UNION CO

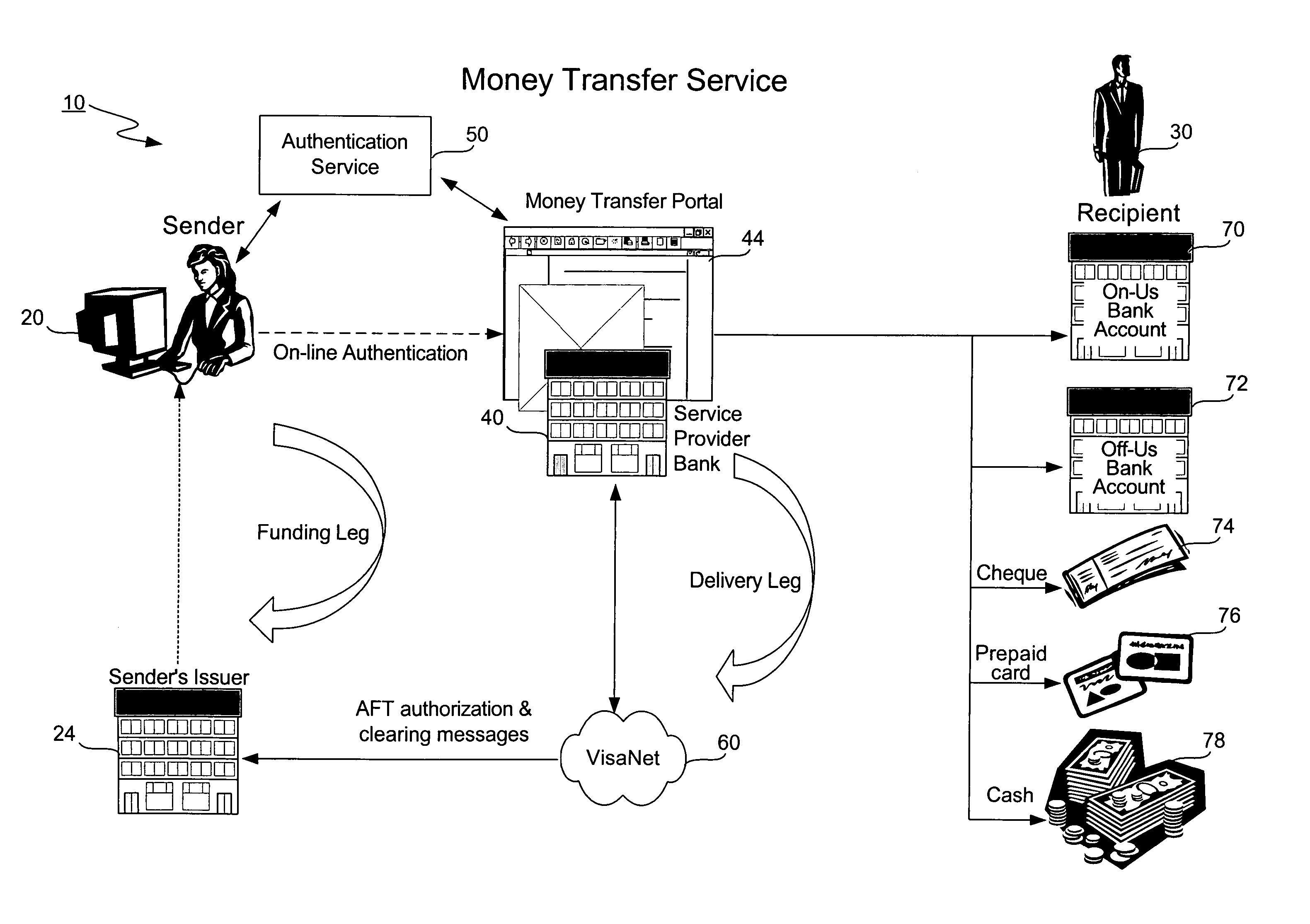

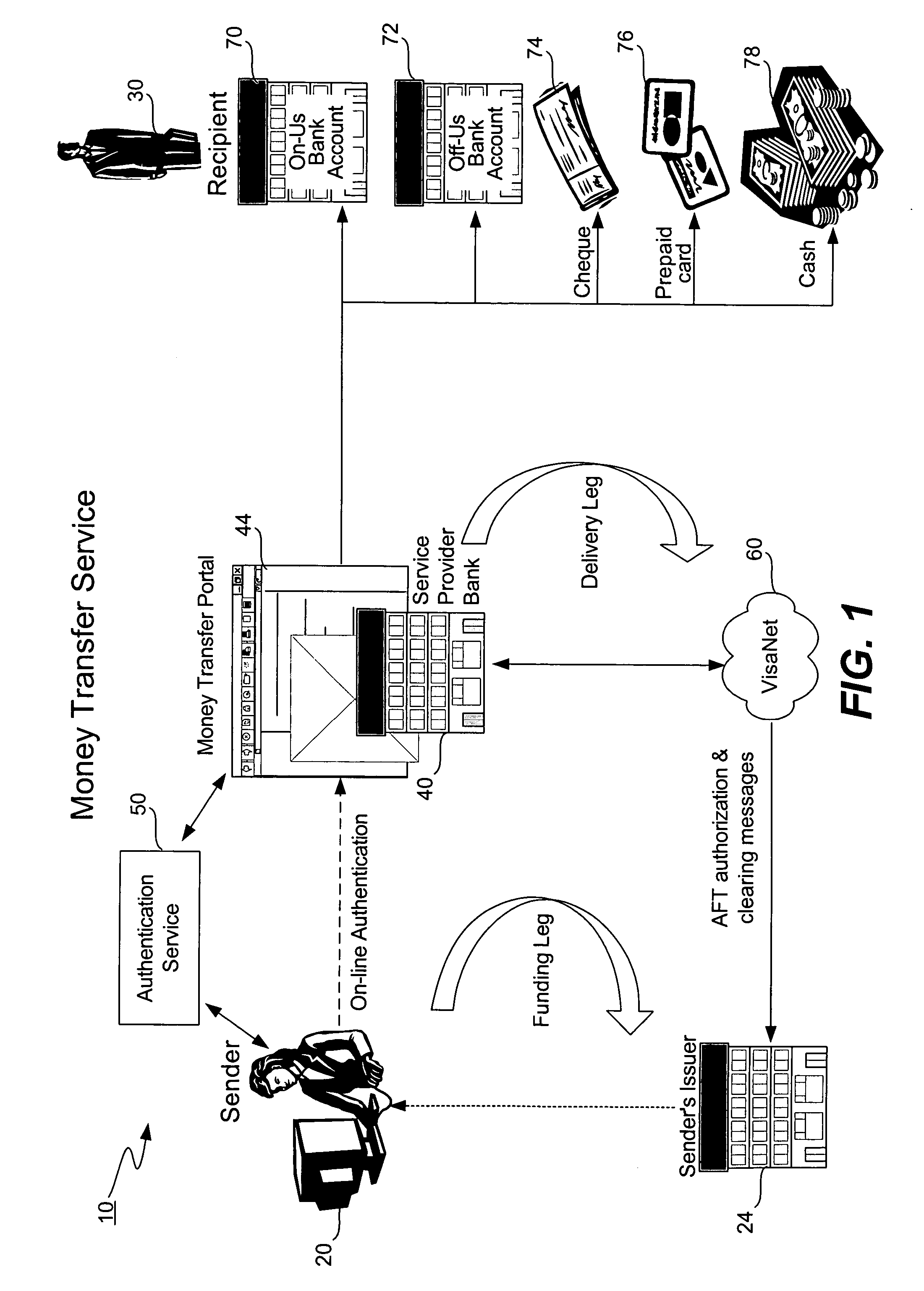

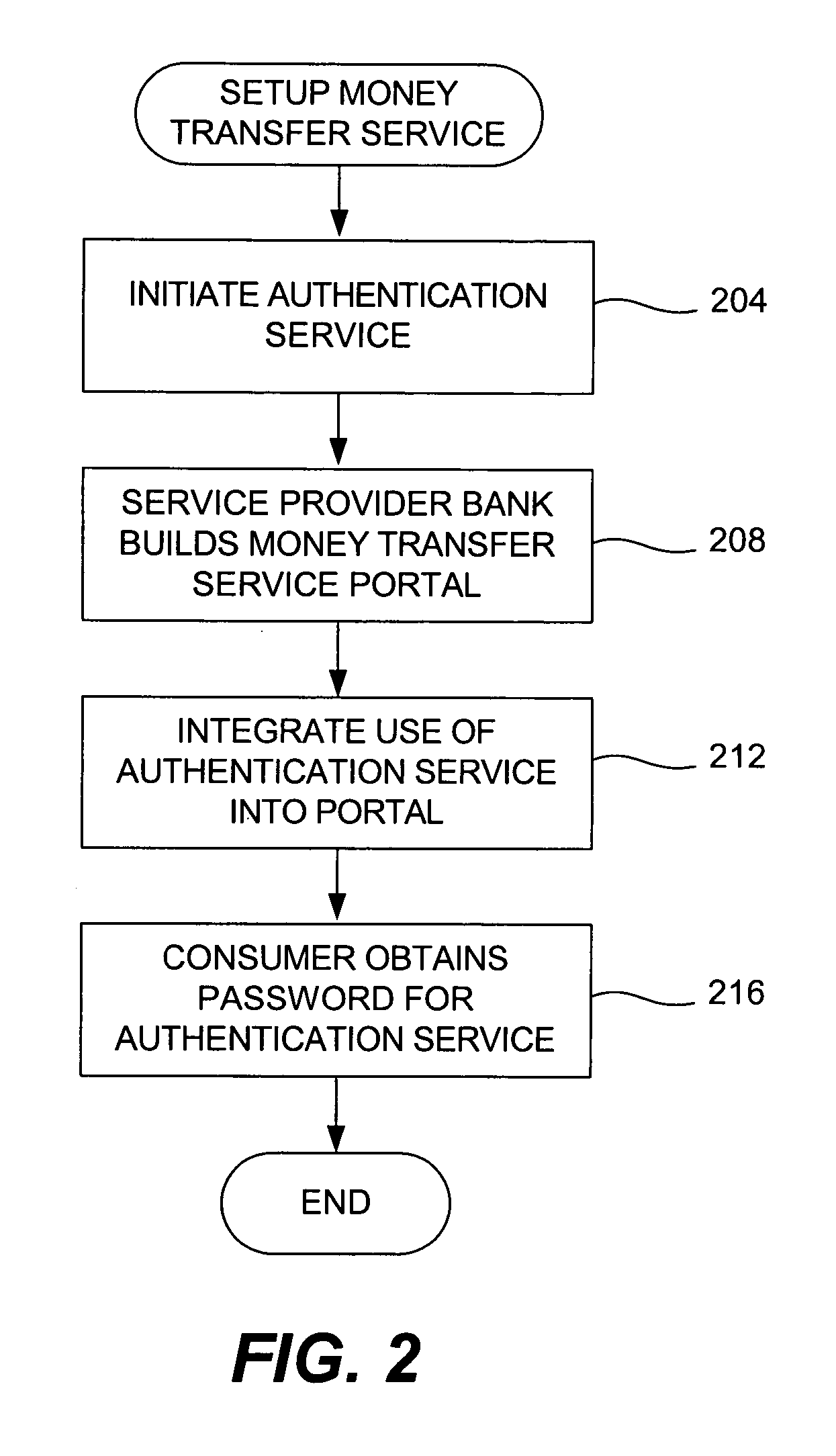

Money transfer service with authentication

ActiveUS20060006224A1Good serviceAvoids cash handling costComplete banking machinesFinancePasswordUse of services

A bank (or merchant) hosts and operates an online money transfer service (or “portal”). A sender logs into the portal and enters payment card and money transfer details and then submits the transaction. An authentication window appears displaying the sender's transaction details and the sender is prompted to enter his or her password. Upon successful authentication, the bank seeks authorization from the card issuer. Upon successful authorization, the bank credits the recipient's local bank account or existing payment card. The recipient can also receive a check, a draft, a prepaid card or cash. The money transfer service is used both cross-border and domestic to effect person-to-person money transfer. The money transfer service uses the “Verified by Visa” authentication service and VisaNet for authorization. Messages over VisaNet are used to deliver funds to a recipient.

Owner:VISA INT SERVICE ASSOC

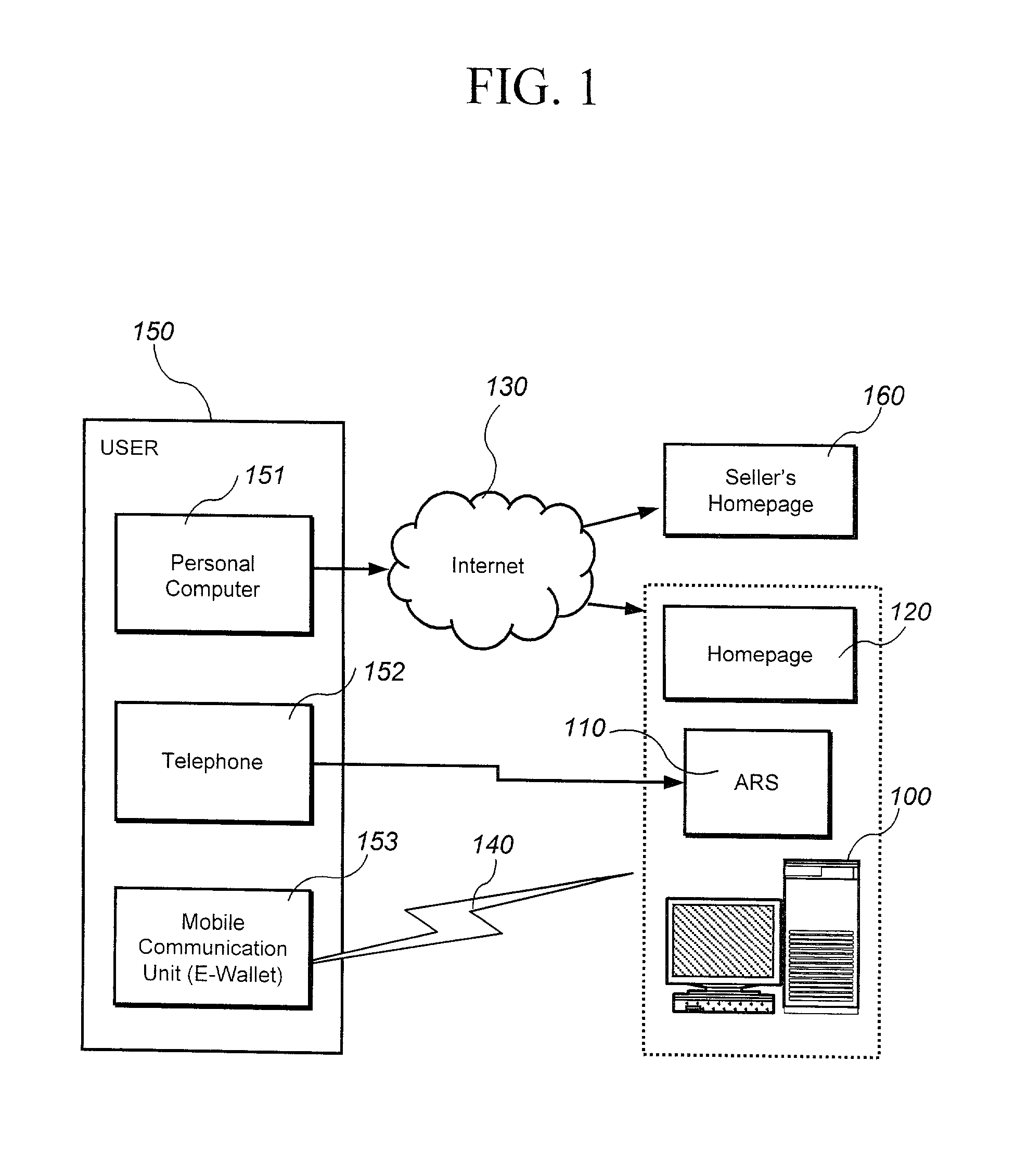

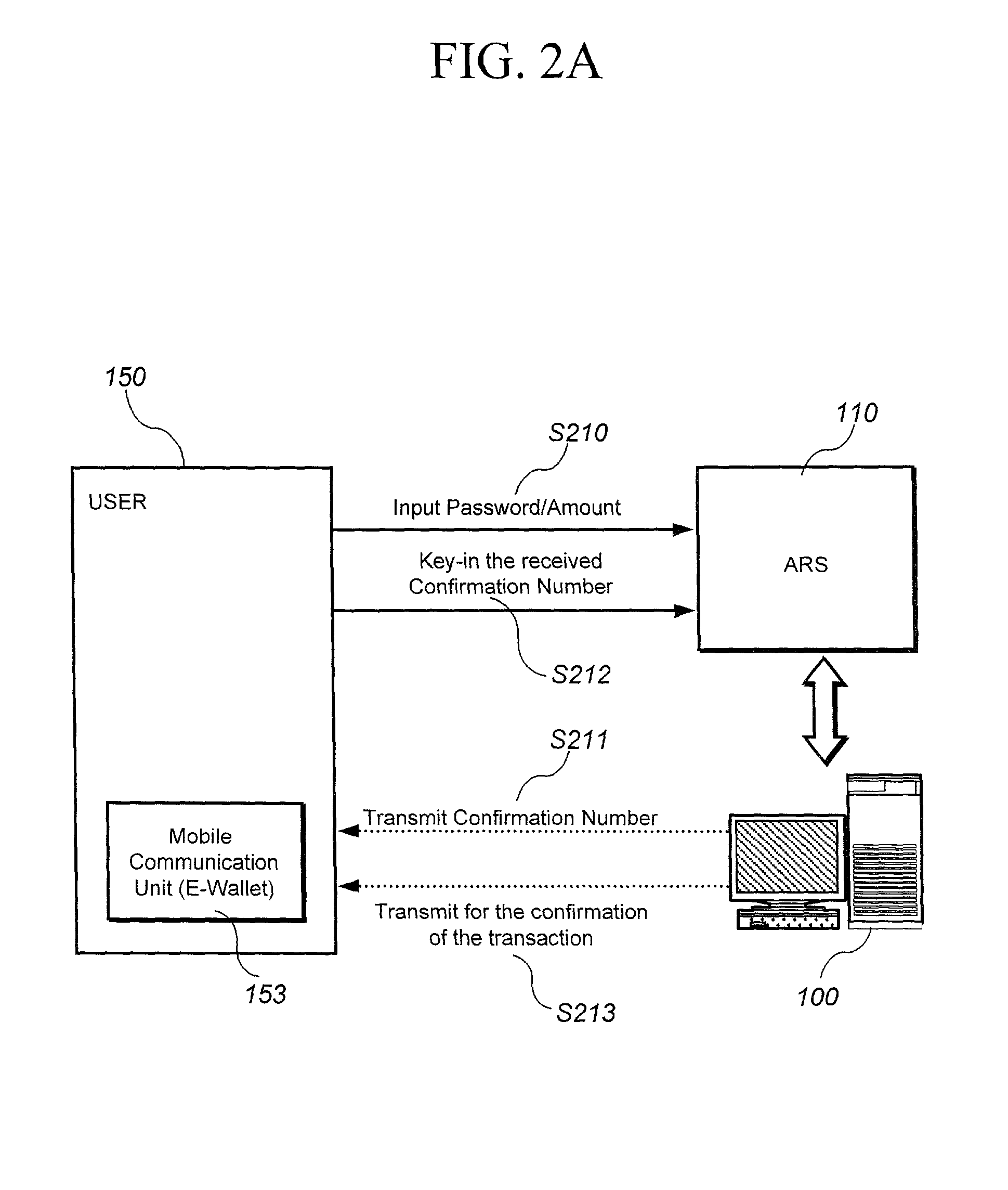

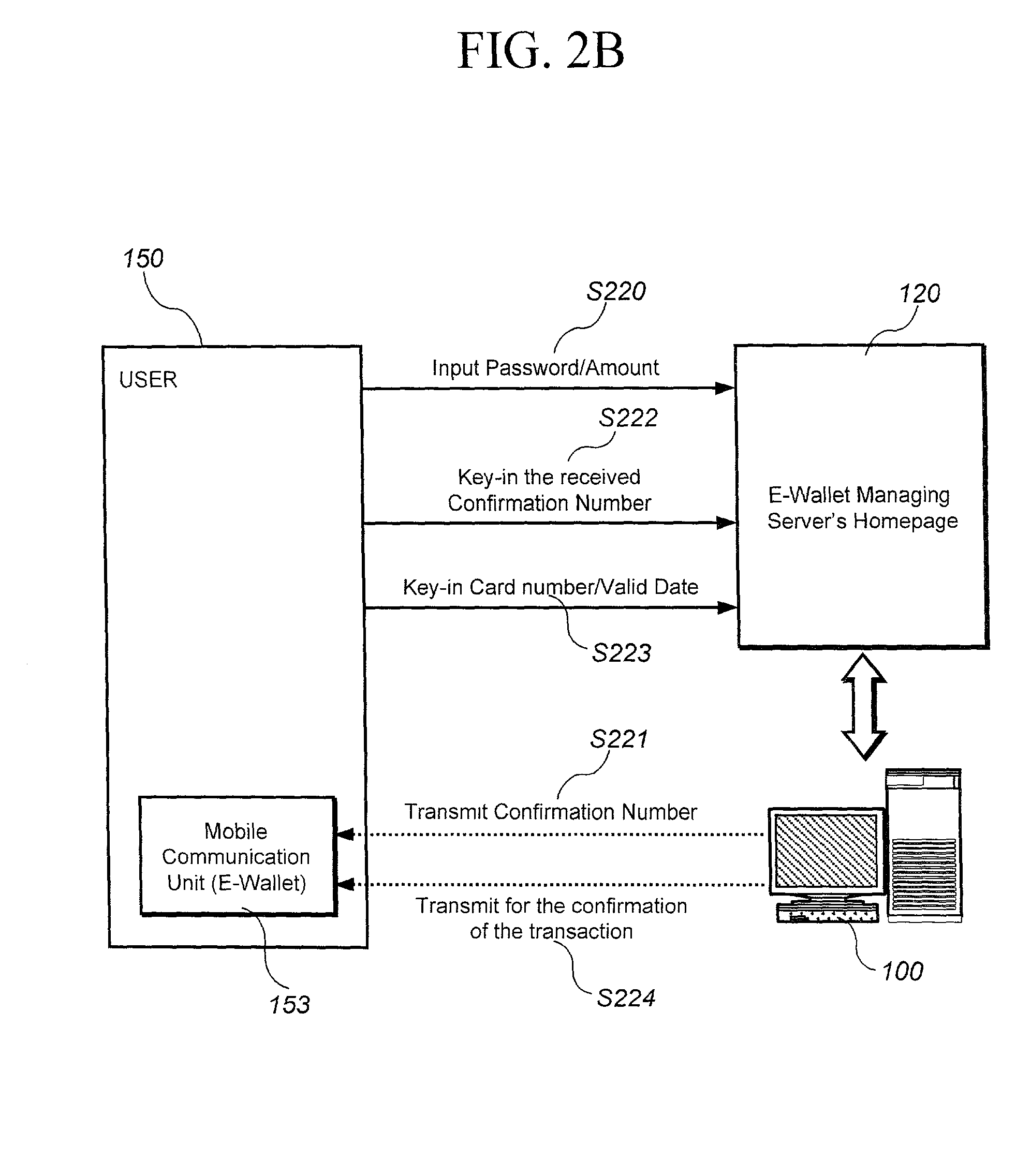

Method and system for transaction of electronic money with a mobile communication unit as an electronic wallet

InactiveUS20010007983A1Performed conveniently and safelyFinancePayment protocolsCommunication unitComputer science

A electronic monetary system comprising a mobile communication unit as an electronic wallet for transactions including electronic payments, money transfer, and recharging the electronic account. The security of the electronic transactions is confirmed by circulating a confirmation number through a loop formed by an E-wallet managing server through the wireless network to the mobile communication unit of the user.

Owner:INFOHUB

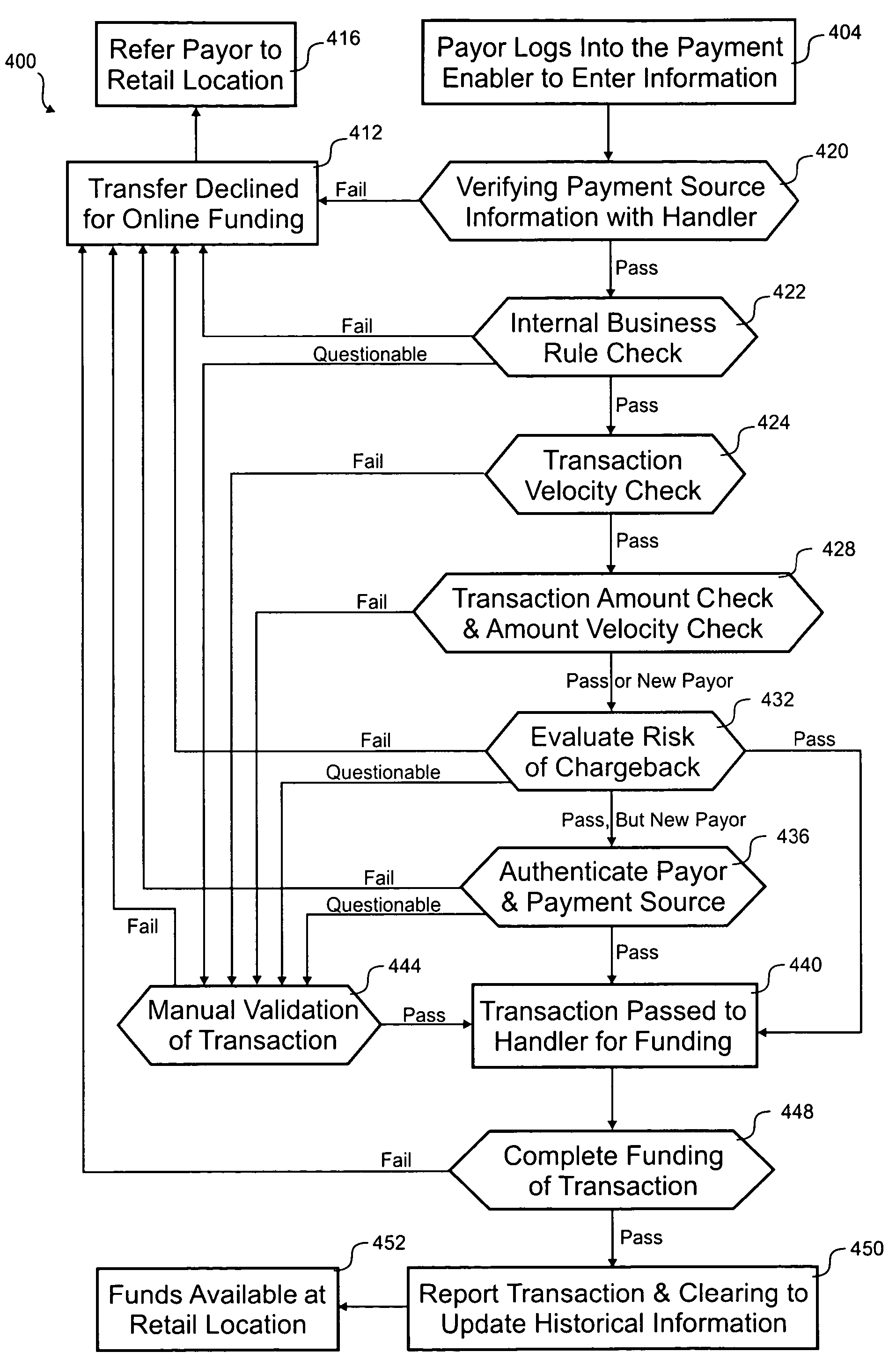

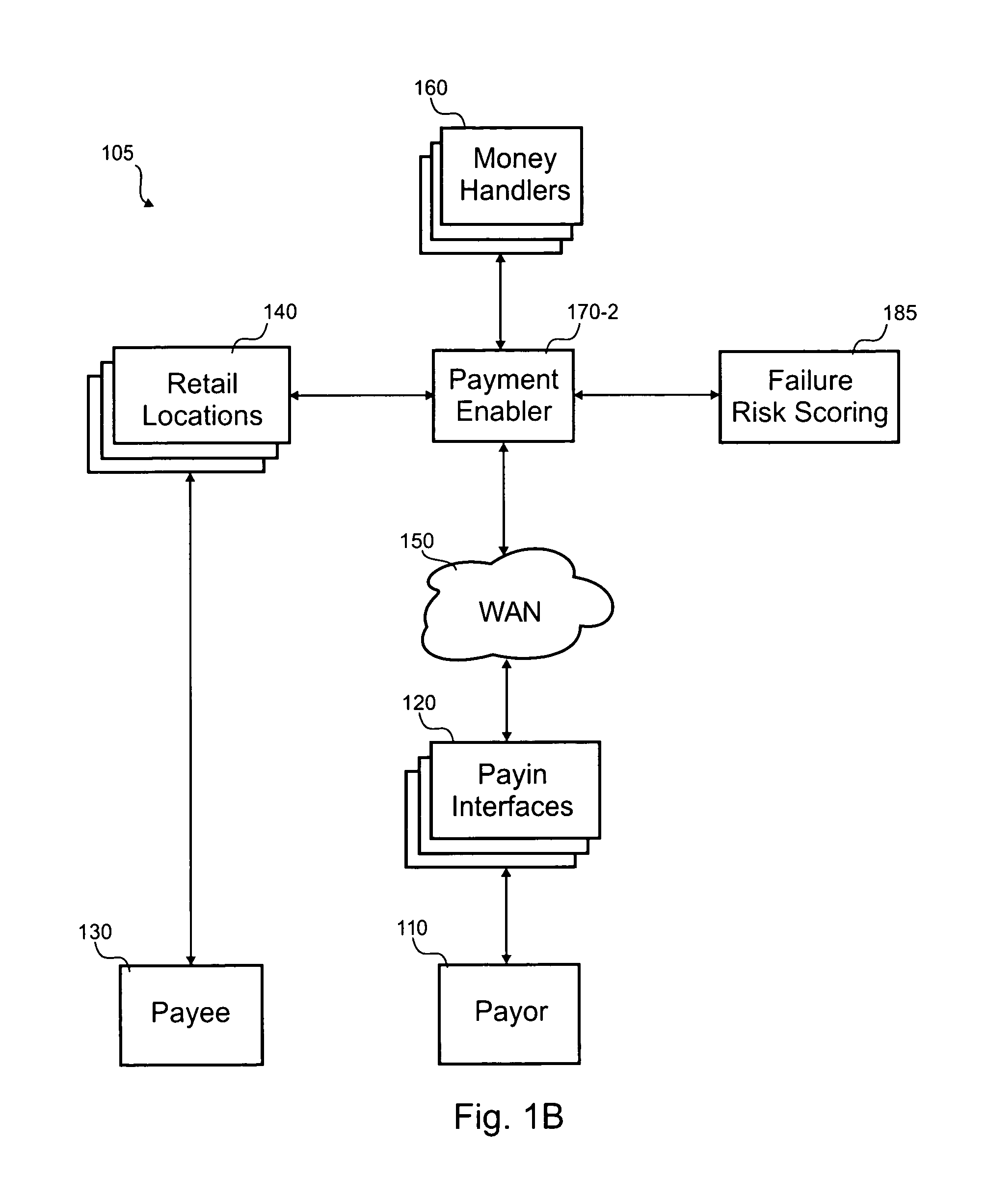

Authentication for online money transfers

According to the invention, a method for processing a transaction where the transaction is initiated by a payor online, but paid to a payee in-person, is disclosed. In one step, payor information is accepted at a location that located across a wide area network from the payor. Transaction information and payment source information is also accepted at the location. The transaction information includes an amount and a payee identifier and the payment source information includes account details associated with an account of the payor at a money handler. A risk related to a likelihood that the transaction will complete successfully is evaluated. Validating that the payment source information is associated with the payor is manually performed if the risk is excessive. The risk can generally be reduced by the manual validation. The money handler is billed for at least the amount. It is determined if the money handler settles the amount. Historical information on the transaction is stored.

Owner:THE WESTERN UNION CO

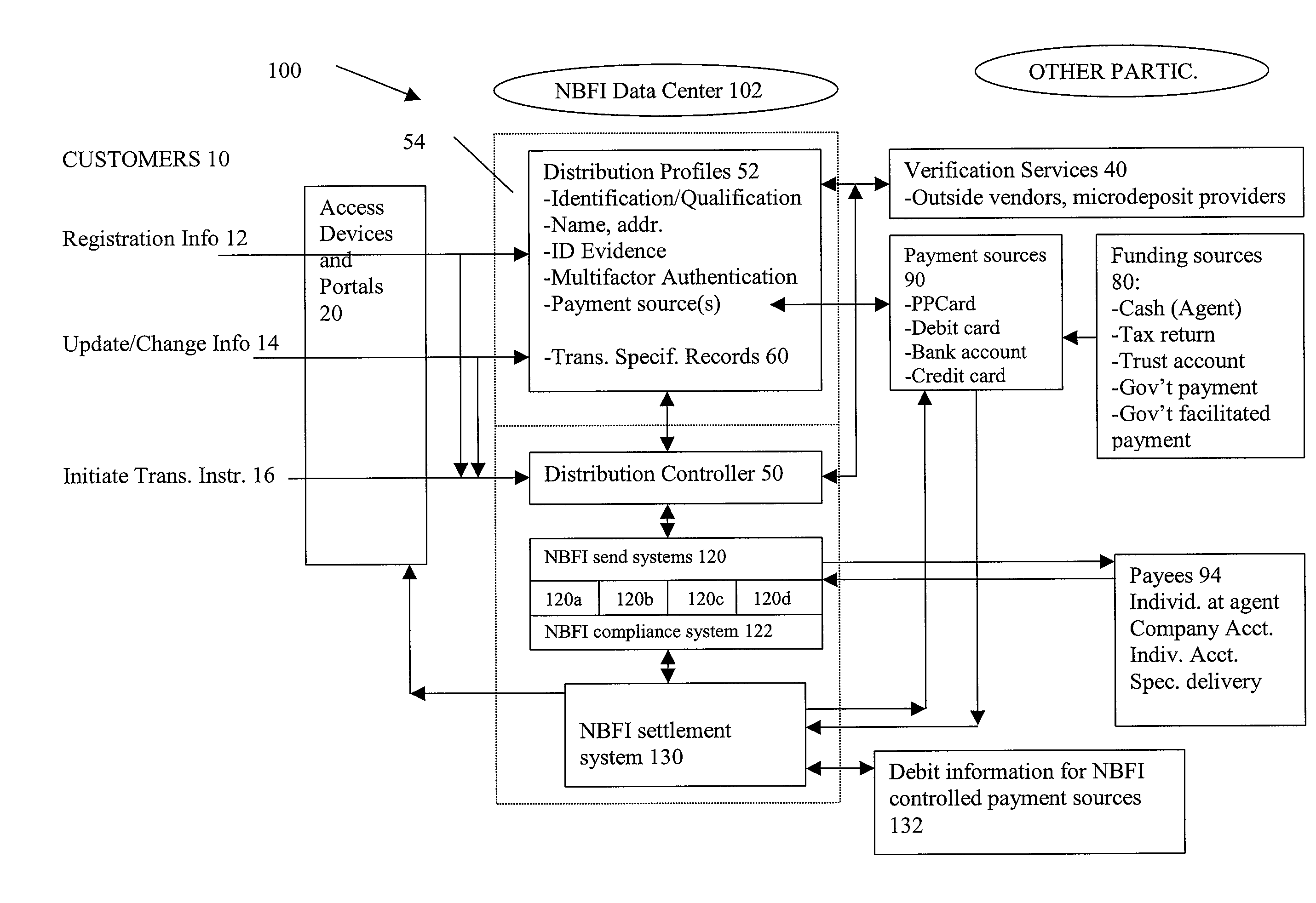

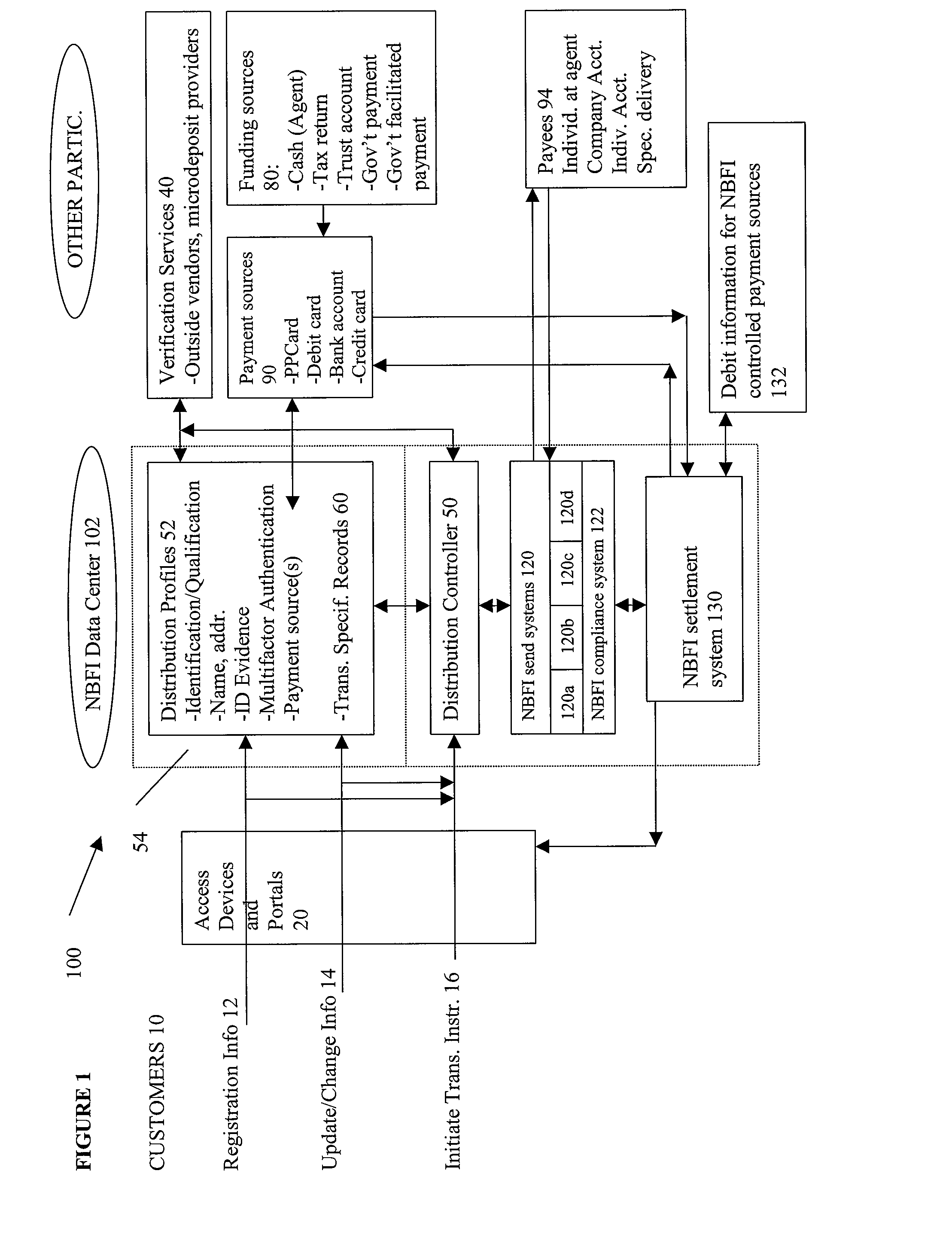

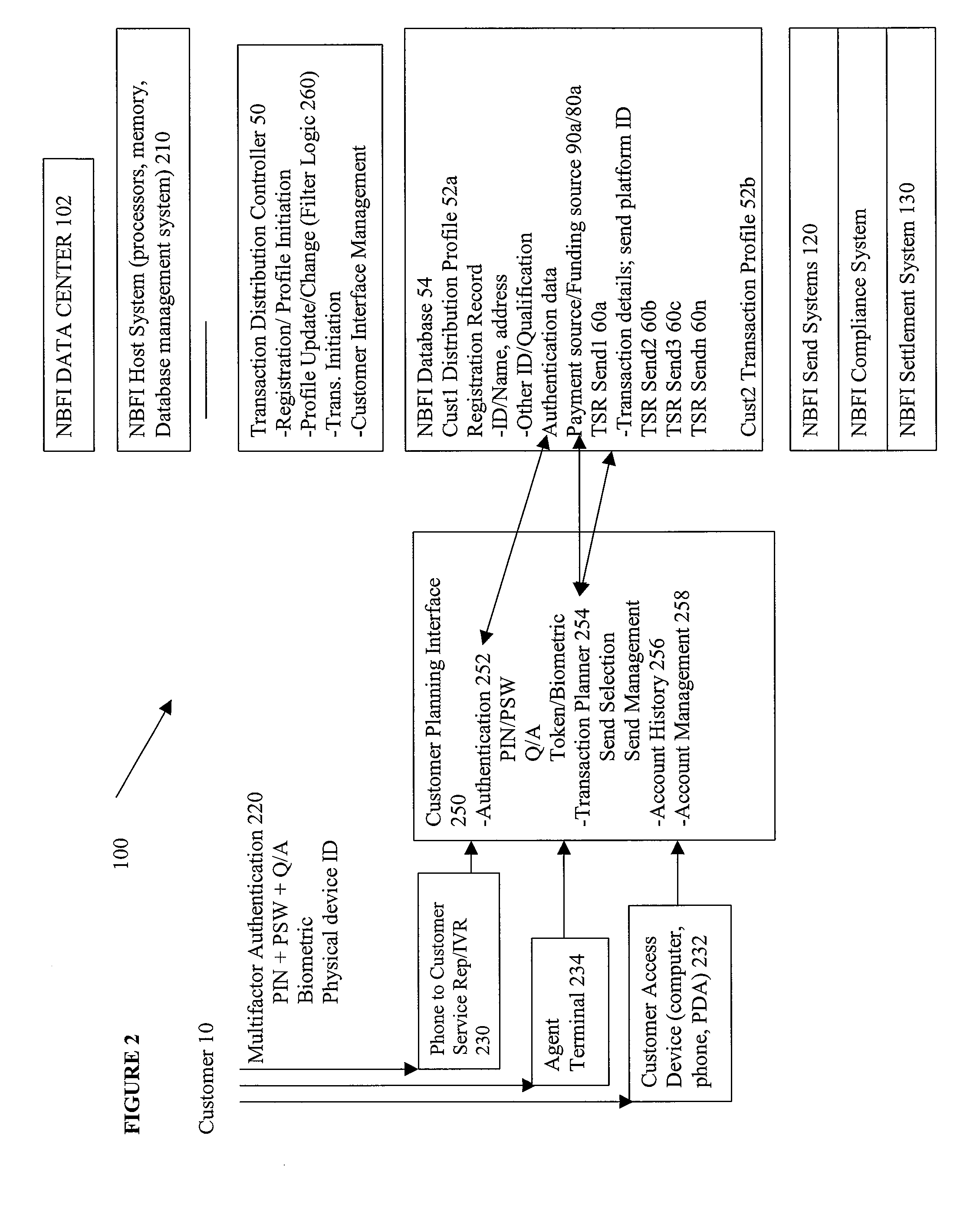

Method and apparatus for distribution of money transfers

A method of performing money transfer send transactions begins with receiving registration information from a customer, including customer identification and qualification information and payment source identification and performing verification of at least a portion of the identification and qualification information and the payment source identification and upon sufficient verification building a distribution profile. The method proceeds by receiving from the customer and storing in the distribution profile send transaction specifications for staging each of one or more proposed send transactions, and receiving a send initiation instruction with associated customer authentication data and responsive thereto identifying a distribution profile and at least one send transaction specification to be executed. Responsive to the send initiation instruction, the method verifies the authentication data and the current status of the payment source identified in the distribution profile and upon sufficient verification, initiates a send transaction according to the at least one send transaction specification.

Owner:MONEYGRAM INT

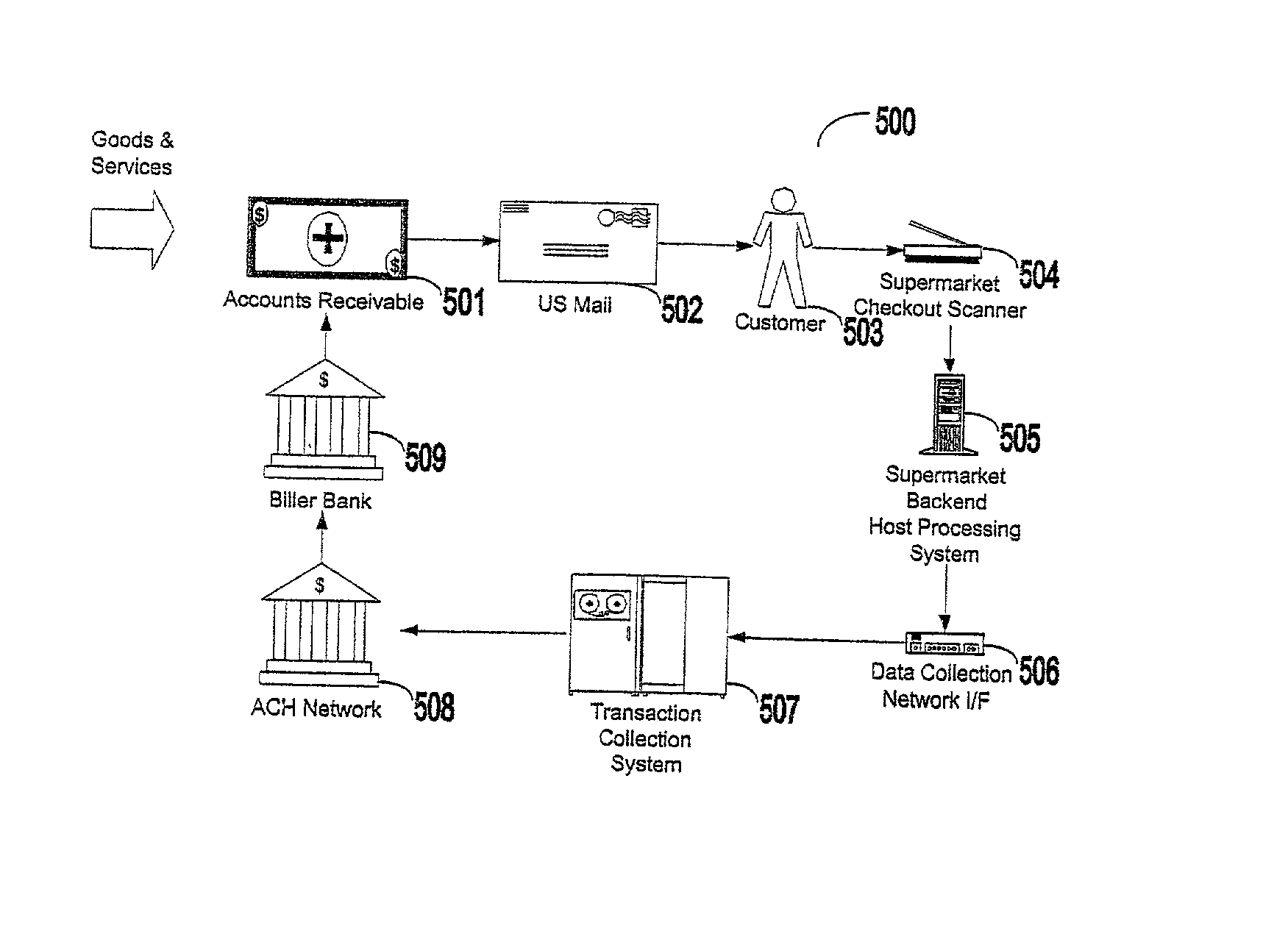

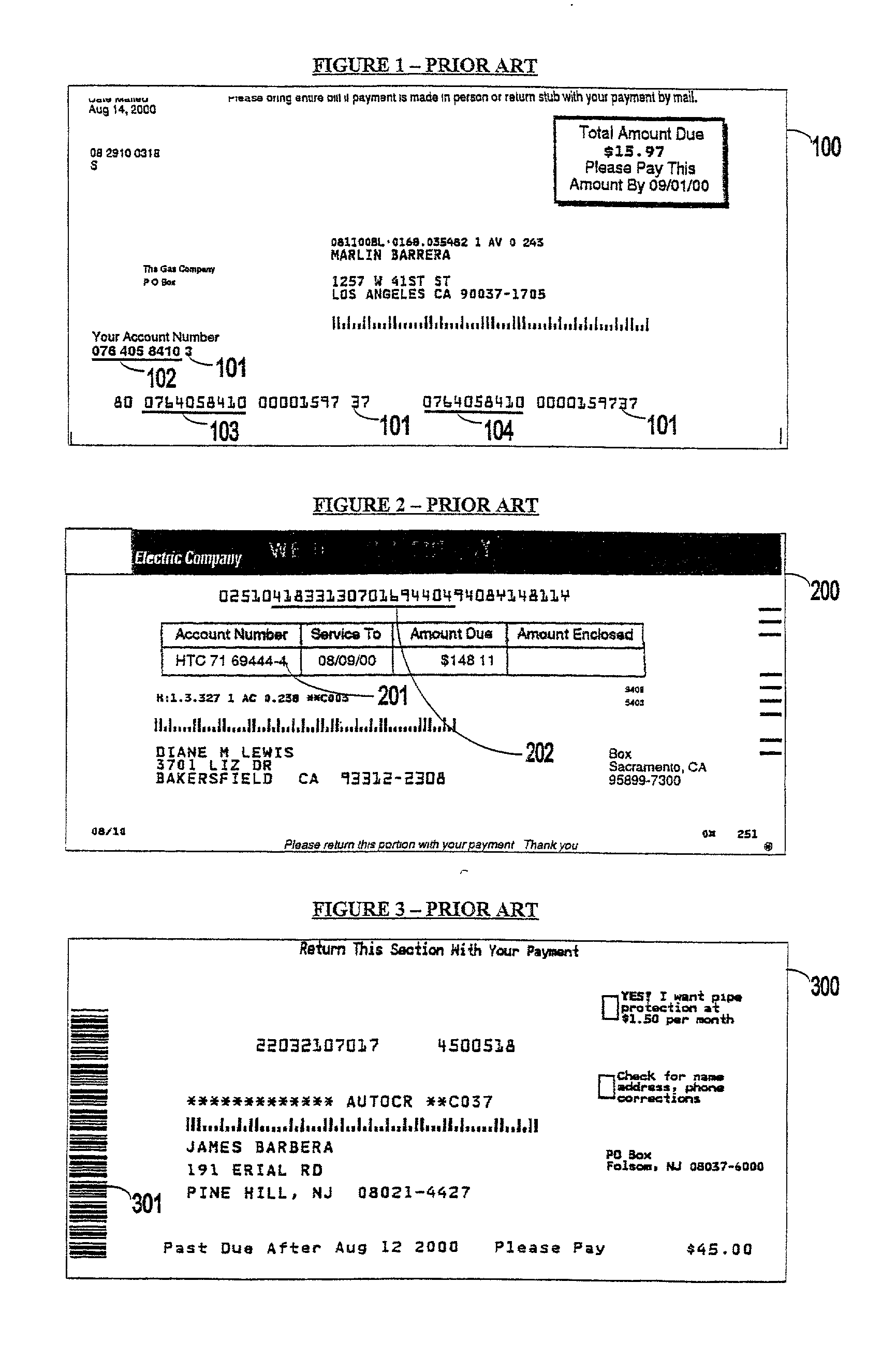

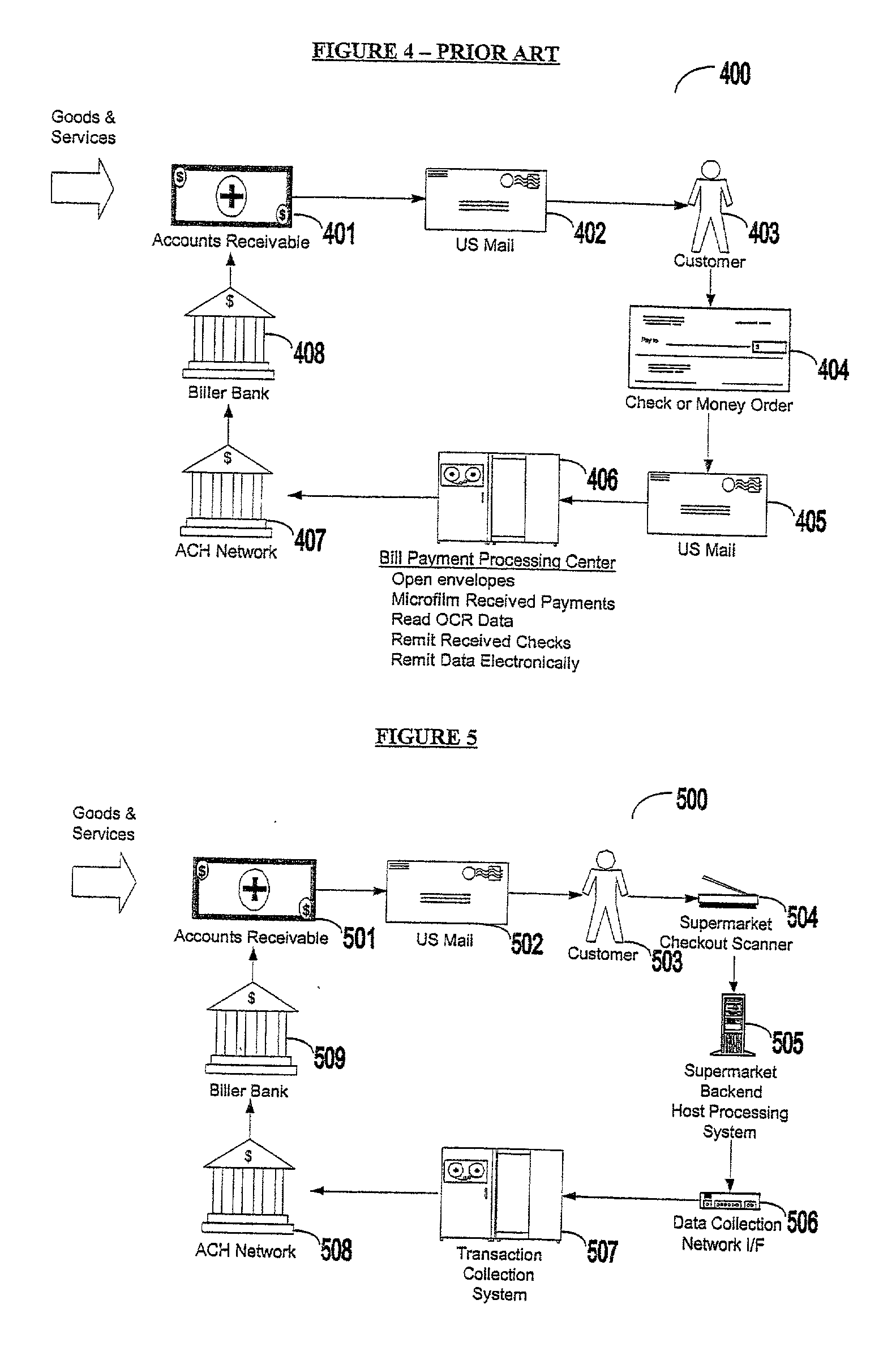

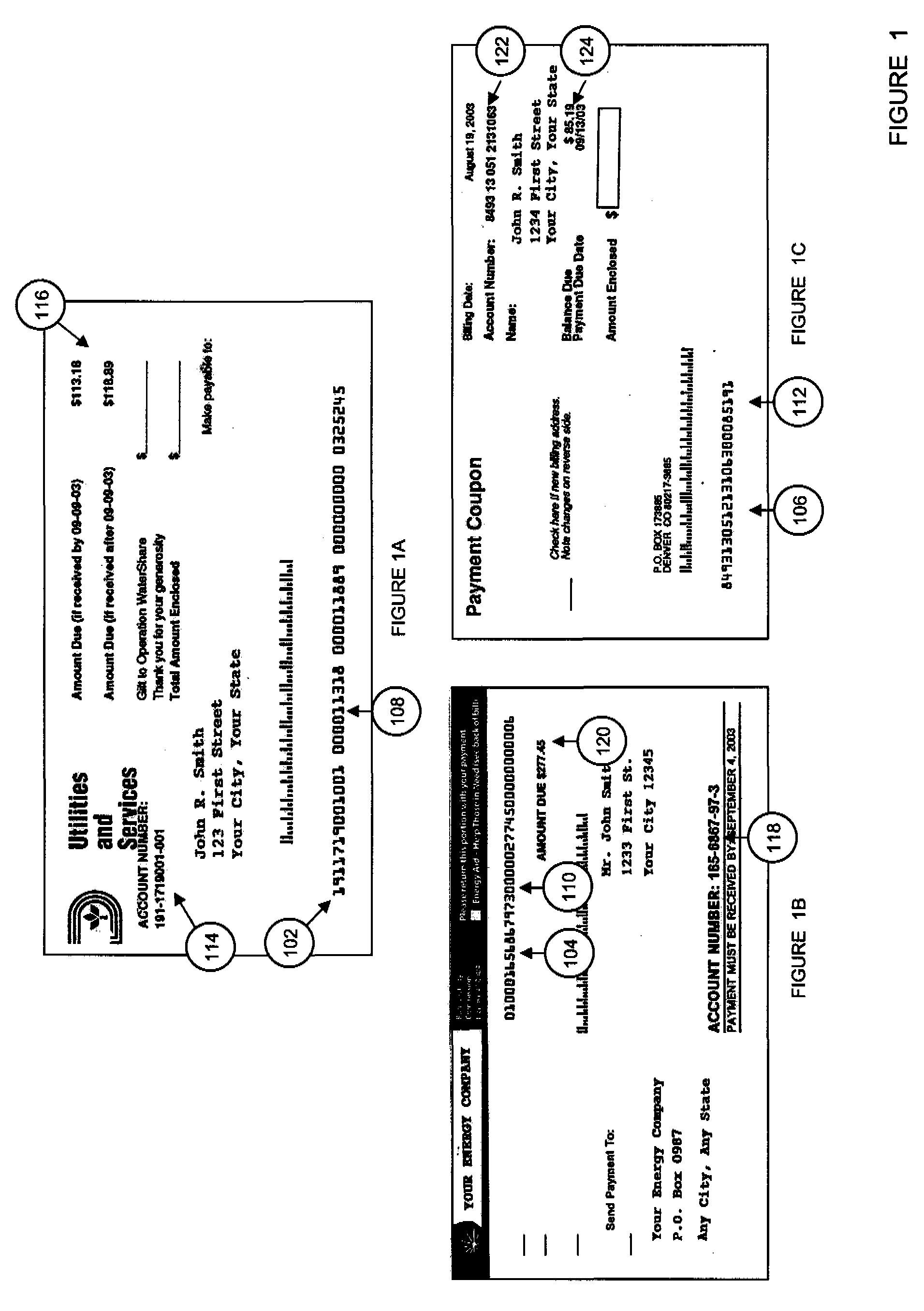

Bar coded bill payment system and method

InactiveUS20020128967A1Inexpensively and easily established and maintainedPay their bills more efficientlyFinancePayment protocolsBank accountBarcode

A system and method for payment is provided, wherein consumers pay their bills at supermarkets, large retail chain, or other stores and receive immediate credit from billers for their payments. Payments are made using a bar code printed on the bill or sent to the consumer, e.g., by fax or email. The biller receives good payment funds, deposited directly into his bank account, and error-free electronic payment data for consumer bill payments by the very next business day. The biller backdates the received bill payments to the time and date the consumer actually paid, regardless of the time that the payment data takes to post to the biller's accounts receivable system. In another aspect, a method for person-to-person money transfers is provided, wherein a bar coded deposit slip, card, or other printout permits a sender to remit finds directly into a receiver's bank account, and such funds are quickly accessible for withdrawal at a nearby automated teller machine, or for a debit card purchase.

Owner:PAYSCAN AMERICA

System and method for transferring money from one country to a stored value account in a different country

InactiveUS20050167481A1Efficient receptionNeed can be stimulatedComplete banking machinesFinanceRemote computerComputer science

One method involves payment of money to a recipient traveling to one or more foreign countries by entering into a remote computer money transfer information from a sender. The money transfer information comprises recipient identification information, at least one country where the money is to be received, and a payment amount in an originating currency. The money transfer information is transmitted to a host computer system. When ready to receive payment in the designated country, recipient identification information along with a request to withdraw a portion of a possible payment amount is entered into a payout computer. The recipient identification information and the request to withdraw is transmitted to a host computer system, and the requested withdrawal is provided to the recipient in the local currency.

Owner:THE WESTERN UNION CO

Systems and methods for evaluating financial transaction risk

Methods and systems are provided for evaluating the risk of conducting financial transaction such as money transfers through representatives. In one embodiment, information generated by a money transfer system regarding a plurality of financial transactions conducted by one or more representatives are received, records of the information are stored in a transaction database, a risk processor is configured to access the transaction database and retrieve risk element data related to transactions conducted by the representative and an analysis of the risk element data is performed using the risk processor. The risk processor may be configured to process the risk element data into one or more risk element values and to calculate a Transaction Risk Index for the representative by comparing one or more of the risk element values to an appropriate risk proxy.

Owner:THE WESTERN UNION CO

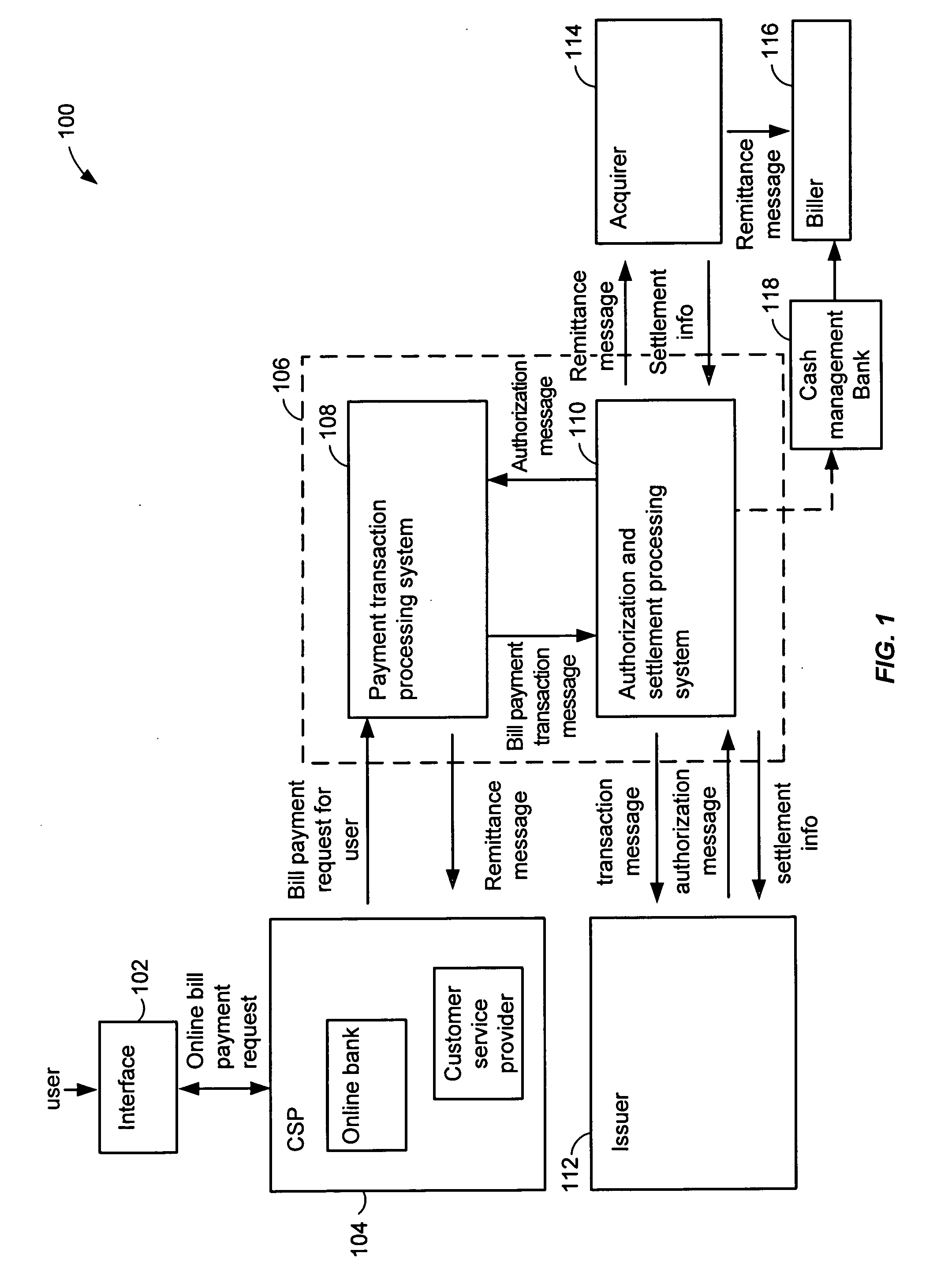

System and method for issuer originated payments for on-line banking bill payments

Techniques for processing on-line banking bill payment requests are provided. A bill payment request is received from an operator of an on-line banking bill payment web site. The operator may be a bank. The request is for payment of a bill using a portable consumer device. A transaction request is then generated for an issuer and sent to the issuer for authorization. The issuer then sends a response indicating whether the transaction request is approved or declined. Remittance information for a biller is generated if the transaction is approved. The remittance information is then forwarded to the operator of the on-line banking bill payment web site for forwarding to a user of the portable consumer device. Additionally, the remittance information is sent to an acquirer or cash management bank, which can forward the information to the biller associated with the bill payment request.

Owner:VISA USA INC (US)

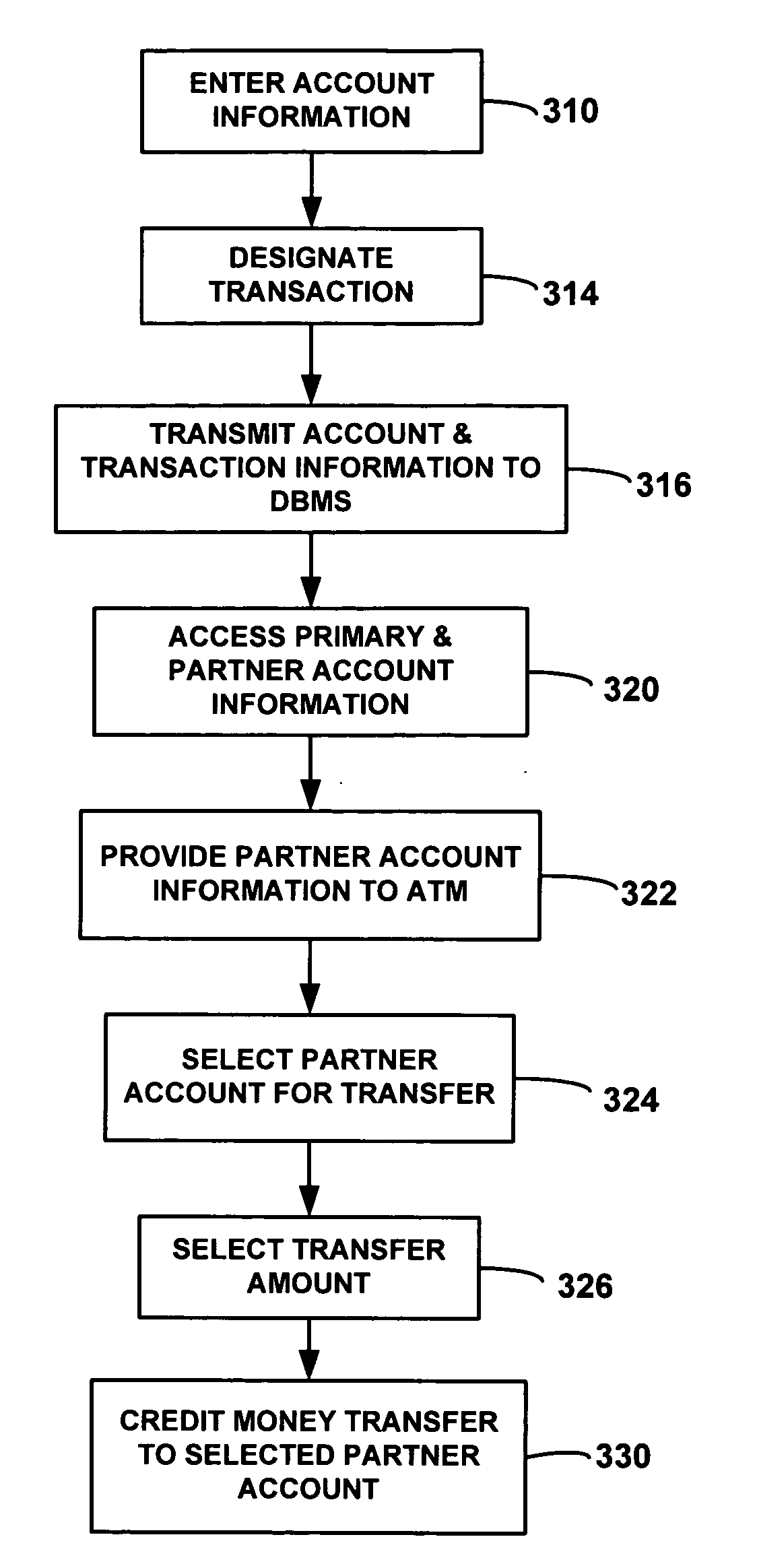

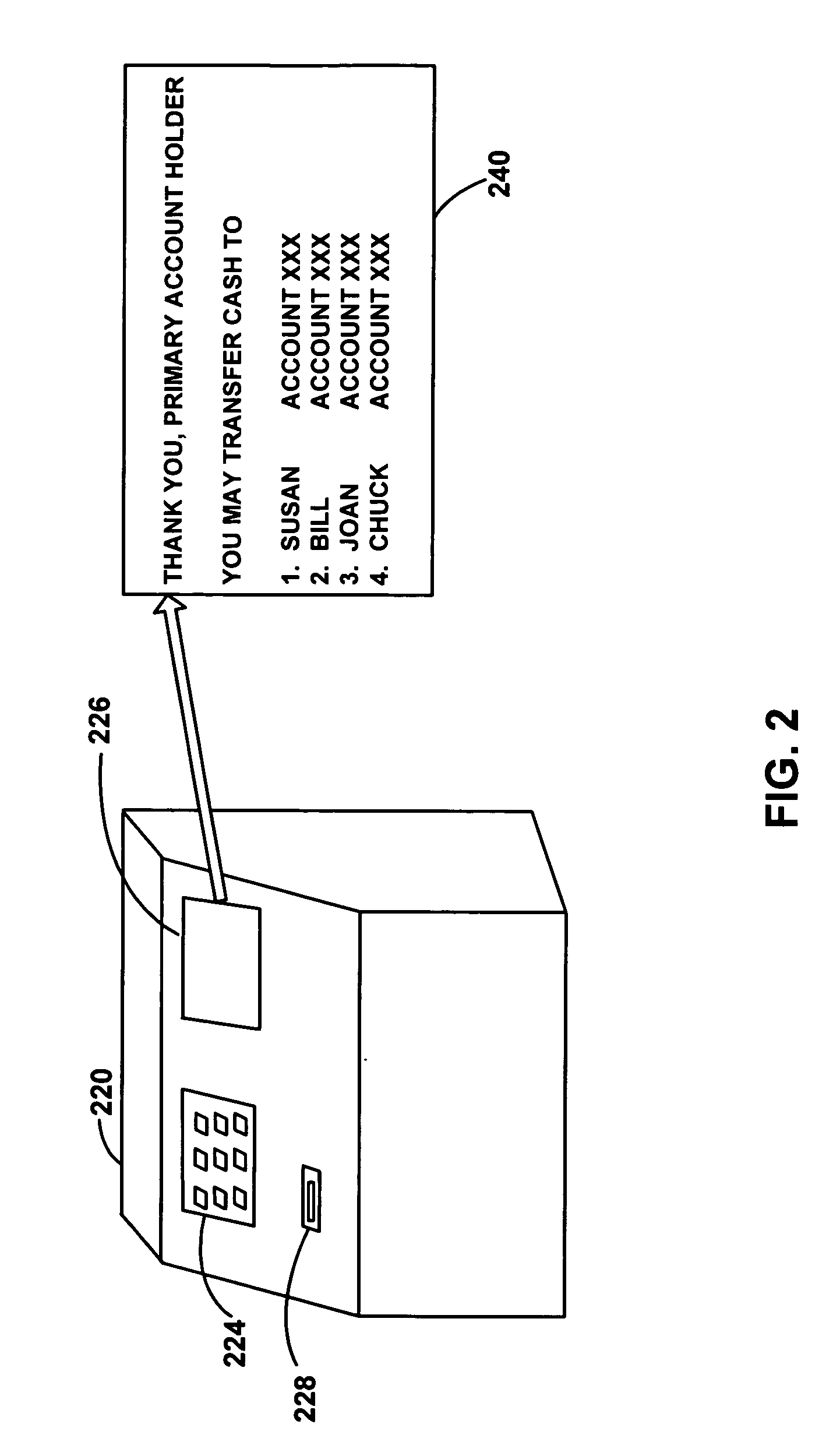

System and method for transferring money

A system and method for facilitating money transfer from a primary account holder to one or more partner accounts. The primary account holder uses a self-service terminal, which displays information on each of several related partner accounts. The displayed partner account information permits the selection of the partner account into which money is to be transferred.

Owner:THE WESTERN UNION CO

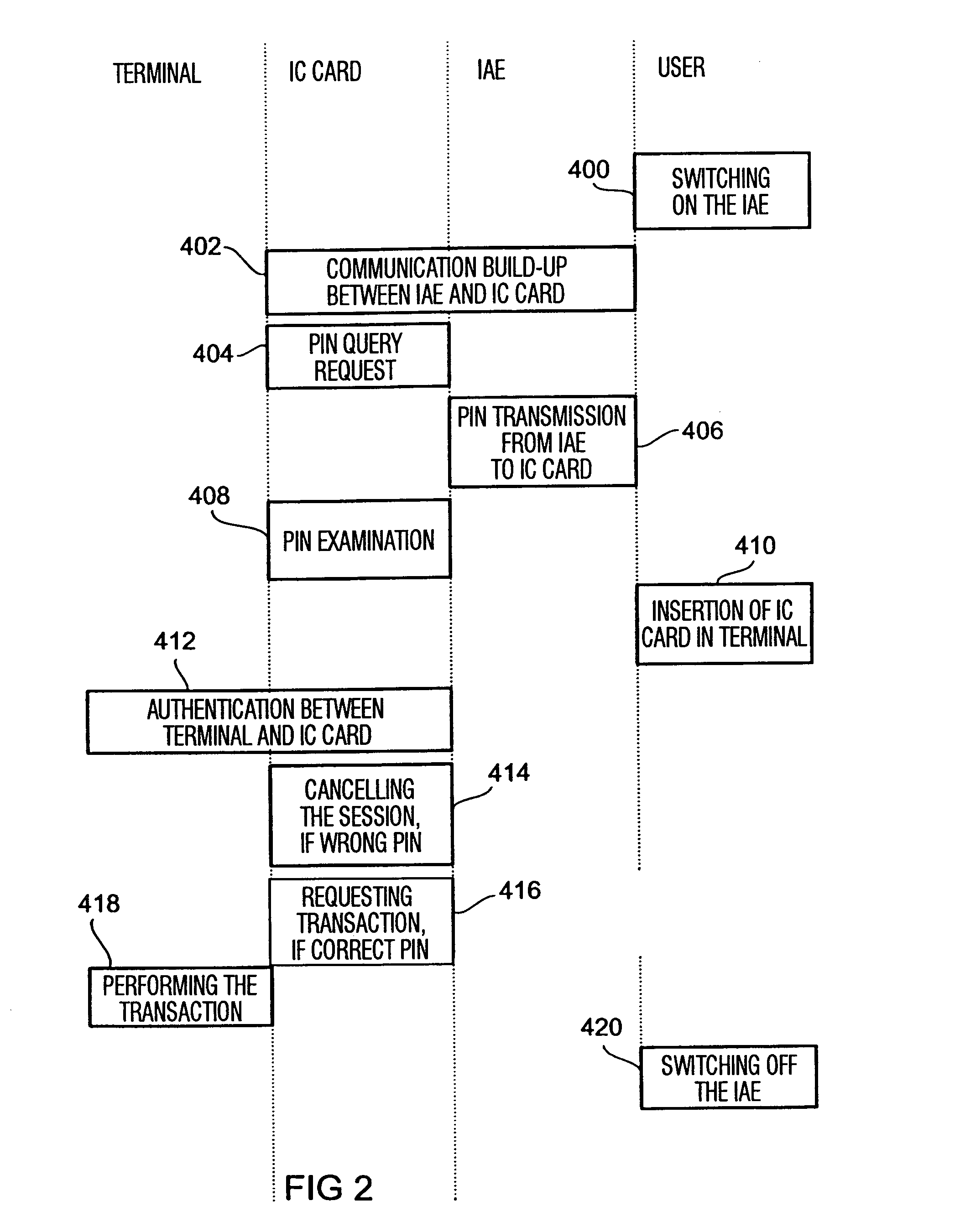

Authorization means security module terminal system

InactiveUS20050103839A1Unauthorised/fraudulent call preventionEavesdropping prevention circuitsInformation transmissionAuthorization

An identification information transmission pathway is separated from a system side to be performed by a mobile authorization means of an owner of a security module in a wireless way. To this end, the security module comprises two interfaces, i.e. one for a communication with a terminal and a further one for wirelessly communicating with the mobile authorization means. The mobile authorization means supplies identification information to the security module for an authentication examination at its part, either stored in the authorization means in a memory or otherwise generated there, like e.g. via biometric sensors, via a keyboard or the like. The security module, performing the examination of the identification information, like e.g. preferably via a zero knowledge method or a zero knowledge protocol, respectively, only then indicates a request for an action at the terminal, like e.g. of a money transfer, when the examination is successful.

Owner:INFINEON TECH AG

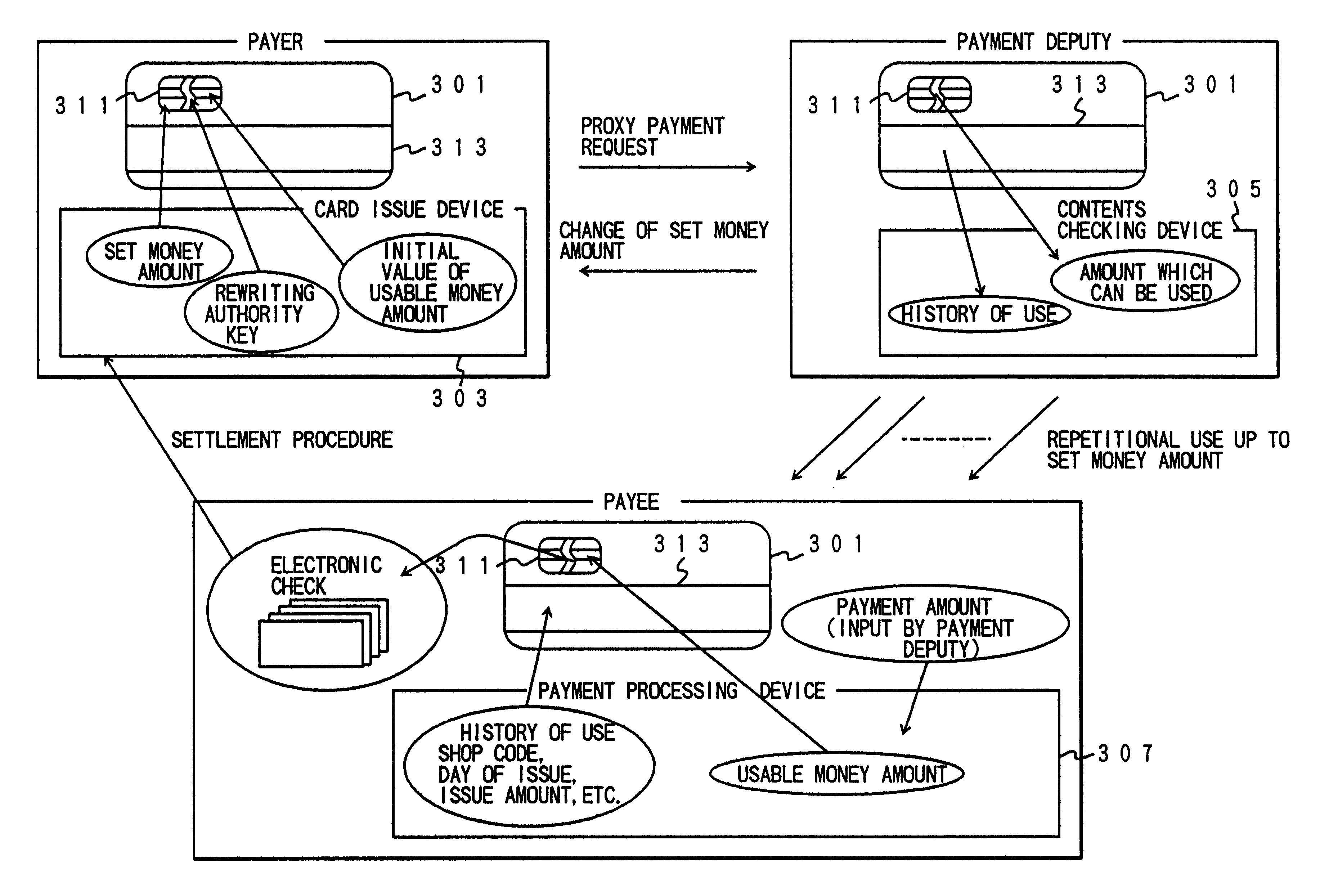

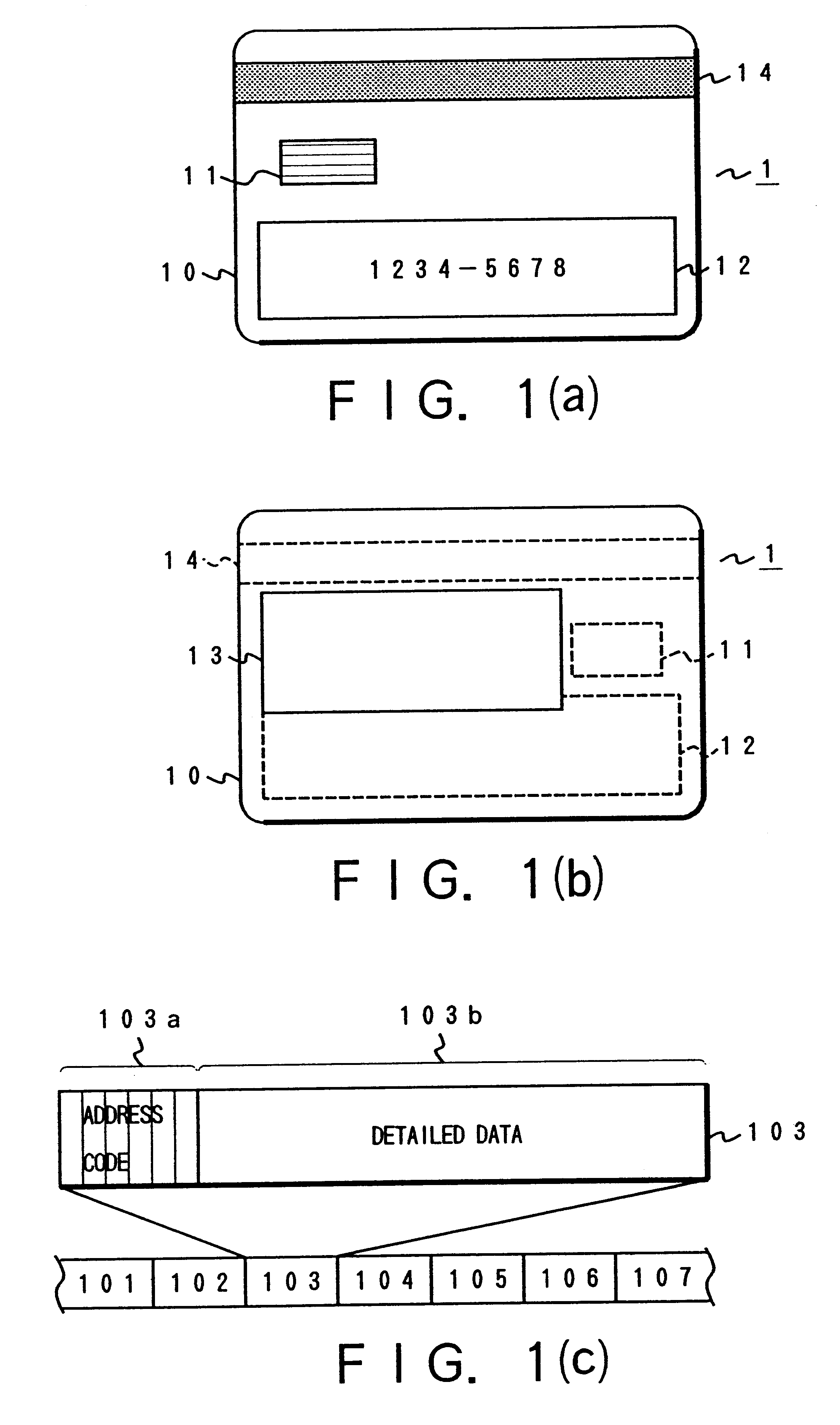

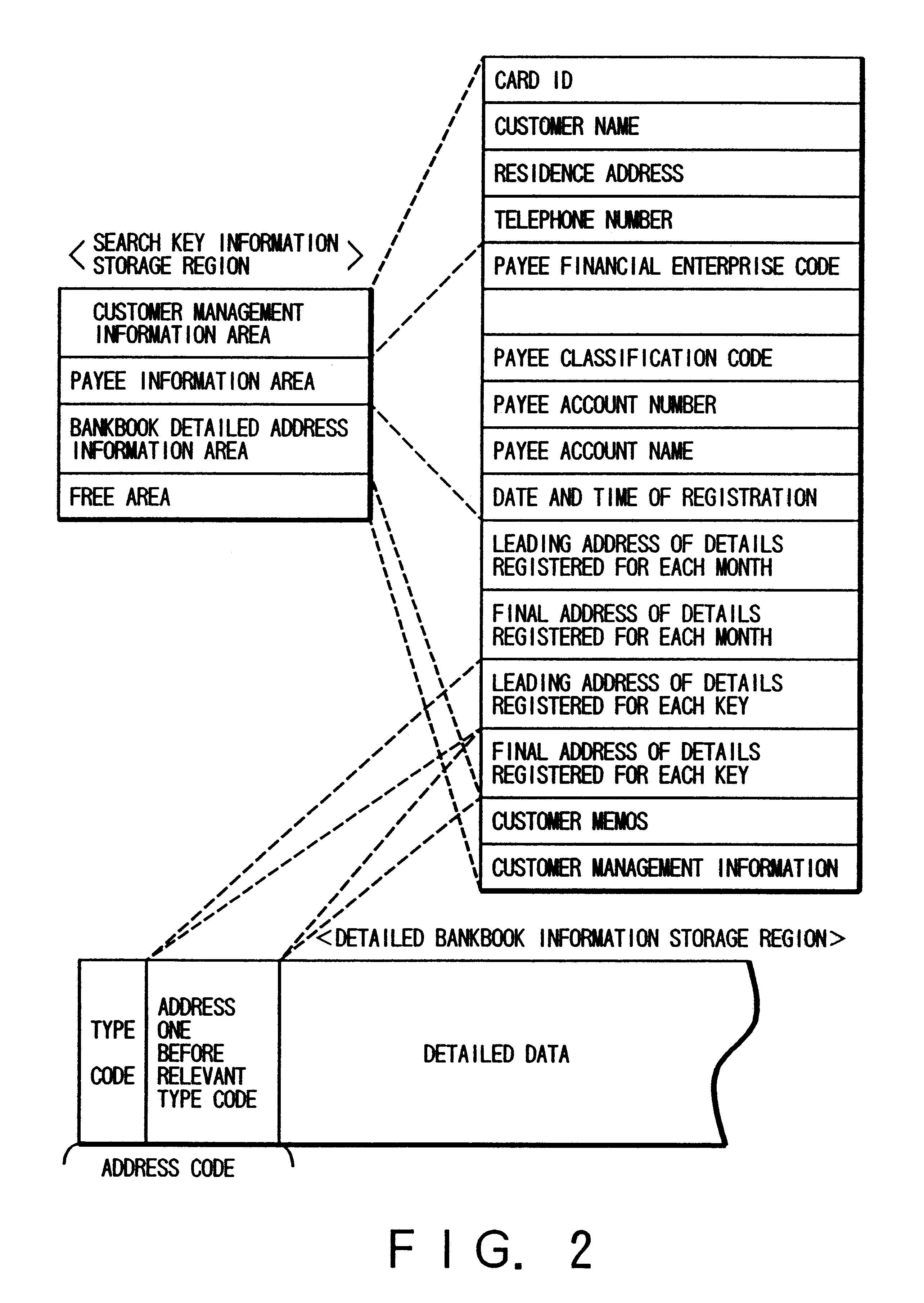

Electronic bankbook, and processing system for financial transaction information using electronic bankbook

The object of the present invention is to propose an account bankbook, a money transfer card, a receipt file, and a checkbook utilizing an optical card, an IC card, or a hybrid optical / IC card. On the surface of a resin card base board 1 are formed an IC chip 11, an optical recording sheet 13, a magnetic stripe 14, and an embossment 12. In a semiconductor memory within the IC chip 11 are written validation keys, search keys, payee information, the upper limit amount of a check, and a program for processing transaction data. Access restrictions corresponding to various applications are imposed upon these data. The history of various cash transactions is recorded in the optical recording sheet 13. These records are of write-once type and rewriting or deletion thereof is impossible.

Owner:N T T DATA TSUSHIN KK

System and method for secure transactions at a mobile device

A system and method for conducting money transfer transactions using mobile devices includes a money transfer host computer that facilitates the collection of fingerprint data for the mobile devices and personal data for users of the mobile devices. The personal data can include a user photo. In order to enable the mobile devices, both the fingerprint data and the personal data are collected, and at least the personal data is verified. To authorize transactions at an enabled mobile device, the fingerprint data and personal data are compared to reference data, and based on the comparison and on a threshold established for the comparison, a transaction is authorized or rejected.

Owner:THE WESTERN UNION CO

Systems and methods of introducing and receiving information across a computer network

One method involves the use of stored value account that may be used, for example, to make internet payments, and that can be credited using a variety of payment techniques. Such a method involves receiving money at a money transfer location from a potential purchaser. The money is then stored as an electronic record in a stored value account of the purchaser. This money is then available for transfer at the request of the purchaser. Upon such a request, the money may be electronically sent to a recipient and the stored value account may be debited.

Owner:THE WESTERN UNION CO

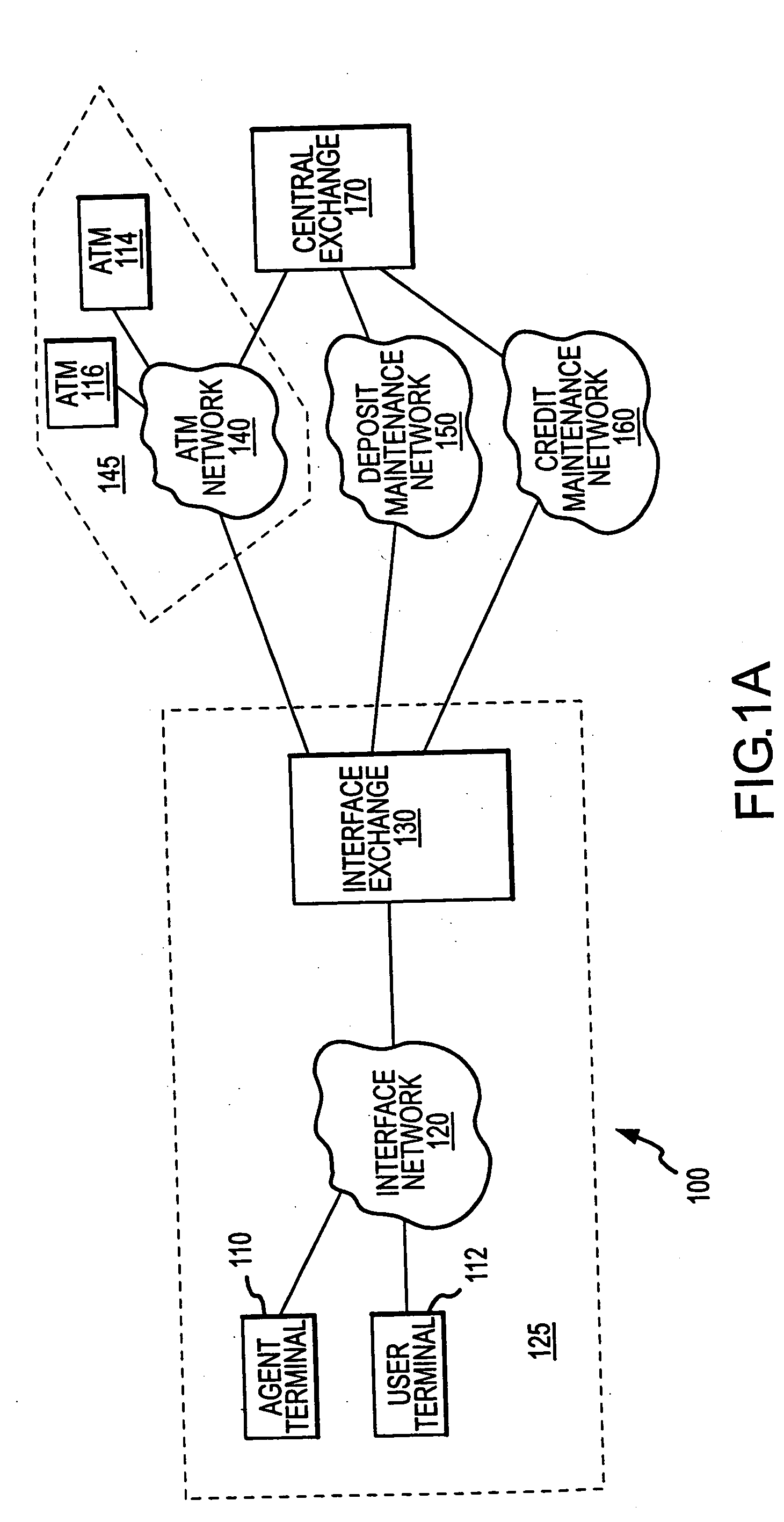

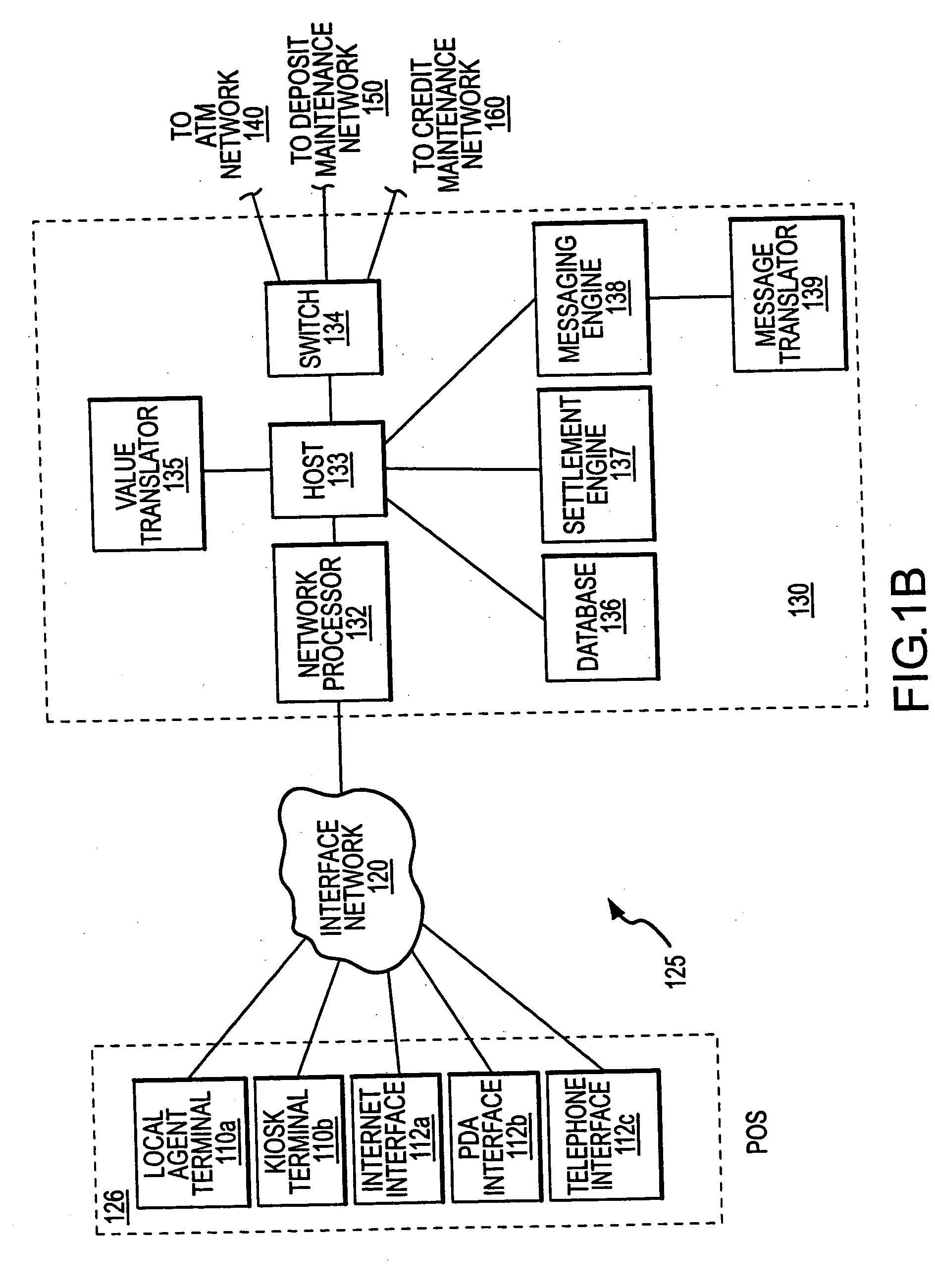

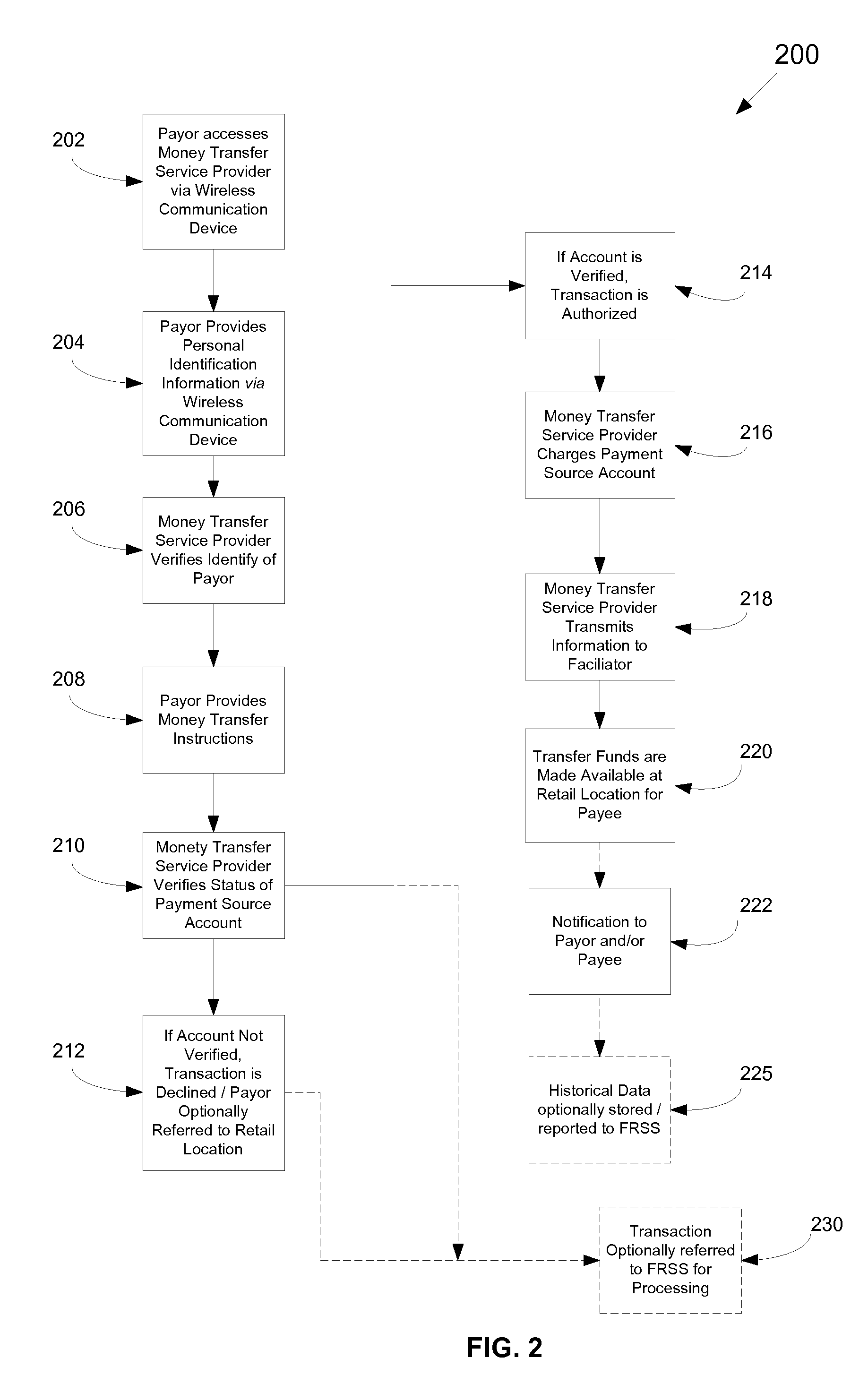

Money transfer transactions via pre-paid wireless communication devices

The present invention generally provides systems and methods for performing money transfer transactions via a wireless communication device, such as a cellular phone. In accordance with the invention, the wireless communication device is associated with, or automatically linked to, at least one payment source account (i.e., the wireless communication device is associated with a payment source account that may be automatically charged for payment of account balances, authorized charges, and / or money transfers). In a preferred embodiment, the wireless communication device is associated with at least one pre-paid payment source account. In one example, the wireless communication device is a pre-paid cellular phone and / or is associated with a pre-paid money transfer account. In certain aspects, the wireless communication device may access a pre-directed phone number, e.g., *55, to access a money transfer service provider. Once connected to a money transfer service provider, a user may initiate a money transfer via the wireless device, which is optionally paid to a payee in-person at a money transfer service provider location.

Owner:THE WESTERN UNION CO

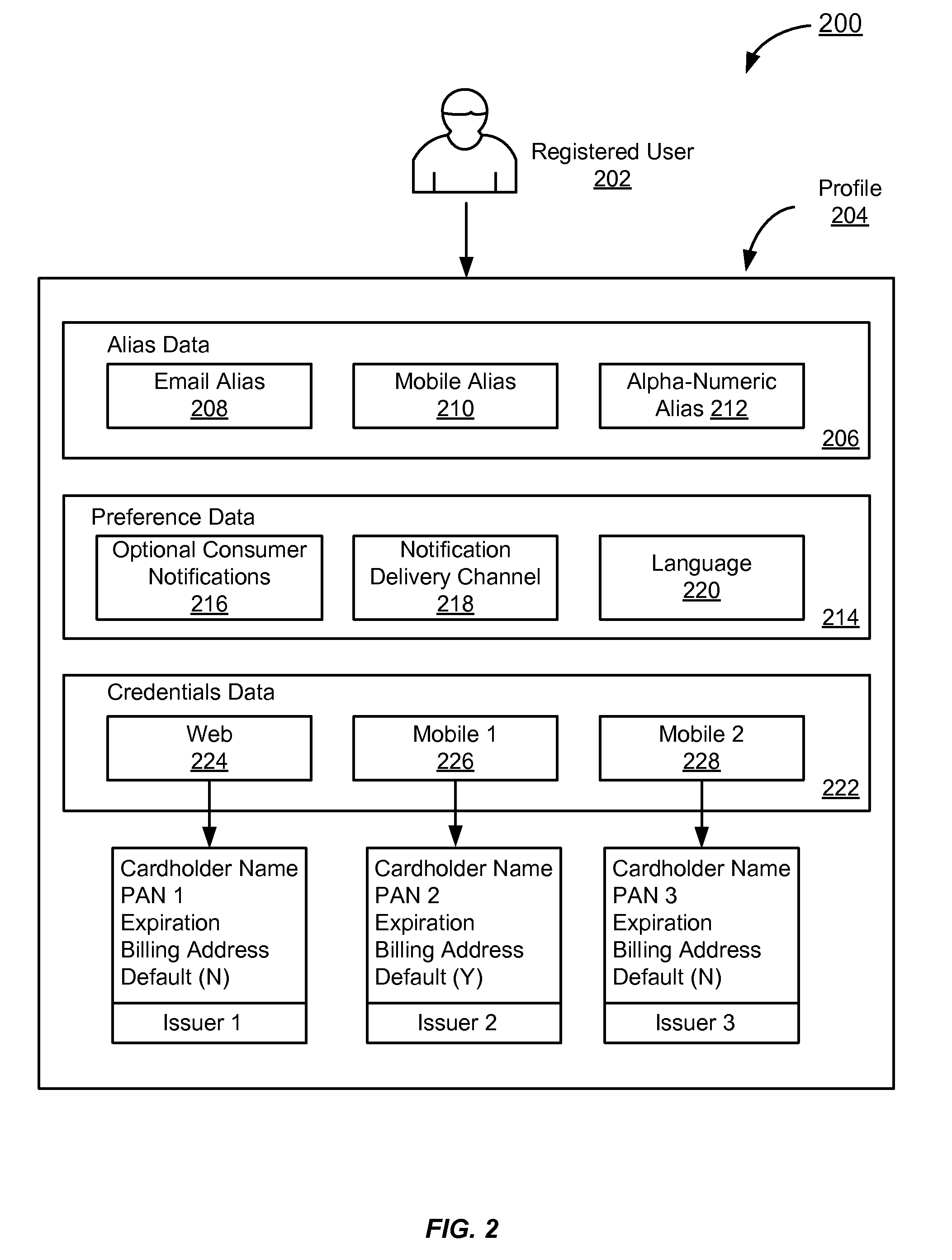

Portable consumer device with funds transfer processing

A portable consumer device with funds transfer processing systems and methods are disclosed. A sending entity may initiate a money transfer from one portable consumer device, such as a credit or debit card, to another portable consumer device through a money transfer system. A sending entity may initiate a payment request and the money transfer system may prompt the sending entity to use one of a plurality of payment account identifiers it possess. A recipient entity is defined by either an alias or a recipient entity personal account identifier. Additionally, an unregistered recipient entity may return a claim code to the money transfer system to claim a money transfer.

Owner:VISA INT SERVICE ASSOC

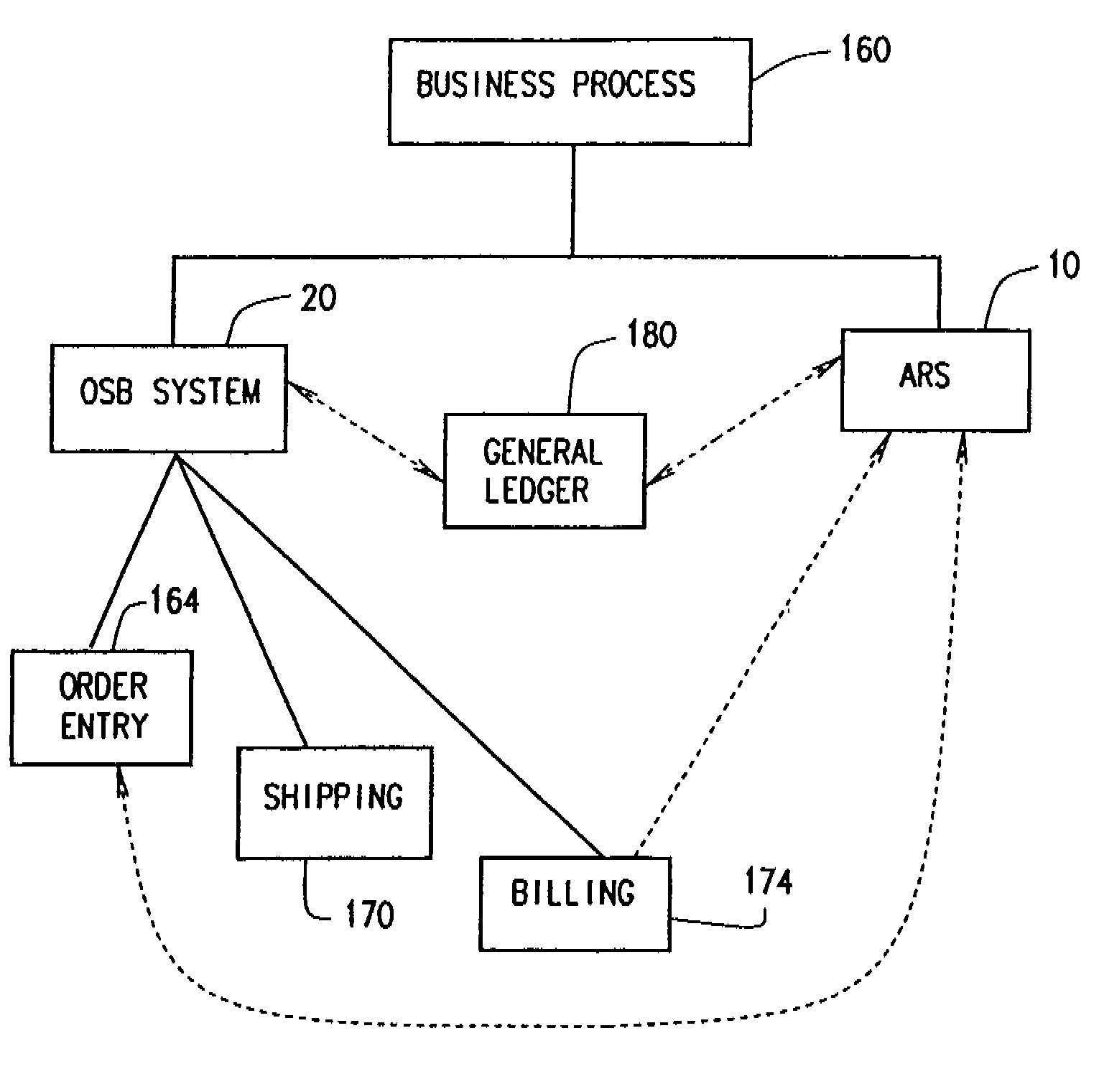

Method and apparatus for managing remittance processing within account receivables

The Account Receivables System's Remittance Processing Module accepts funds in domestic and foreign currency and translates the funds into the required local currency for reporting purposes. The Remittance Processing Modules automatically generates and also performs exchange gain and loss calculations Auto Draft and Reverse Application functions. The Remittance Processing Module accepts funds electronically, and, under certain conditions, automatically applies and updates a customer's account in the most efficient manner.

Owner:GENERAL ELECTRIC CANADA EQUIP FINANCE G P

System and method for secure transactions using device-related fingerprints

A system for conducting money transfer transactions includes a wallet application at a mobile network host that facilitates the collection of fingerprint data at a mobile user device and that maintains wallets where the fingerprint data corresponding to a user device is stored as a reference fingerprint. The fingerprint data includes both device feature characteristics and device use characteristics. When a transaction is conducted a the user device, current fingerprint data from the user device is compared to the reference fingerprint, and the transaction is permitted based on the comparison.

Owner:THE WESTERN UNION CO

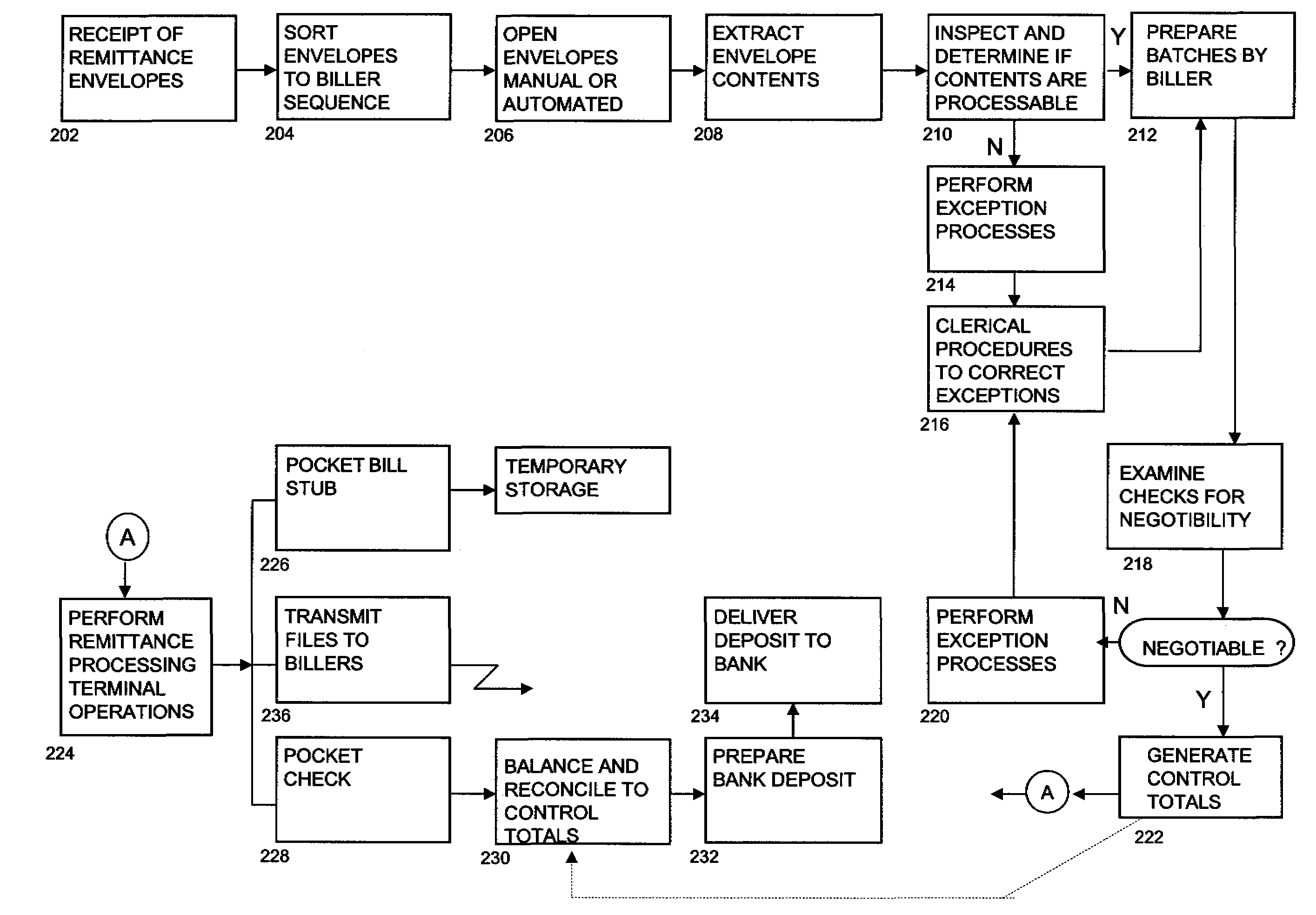

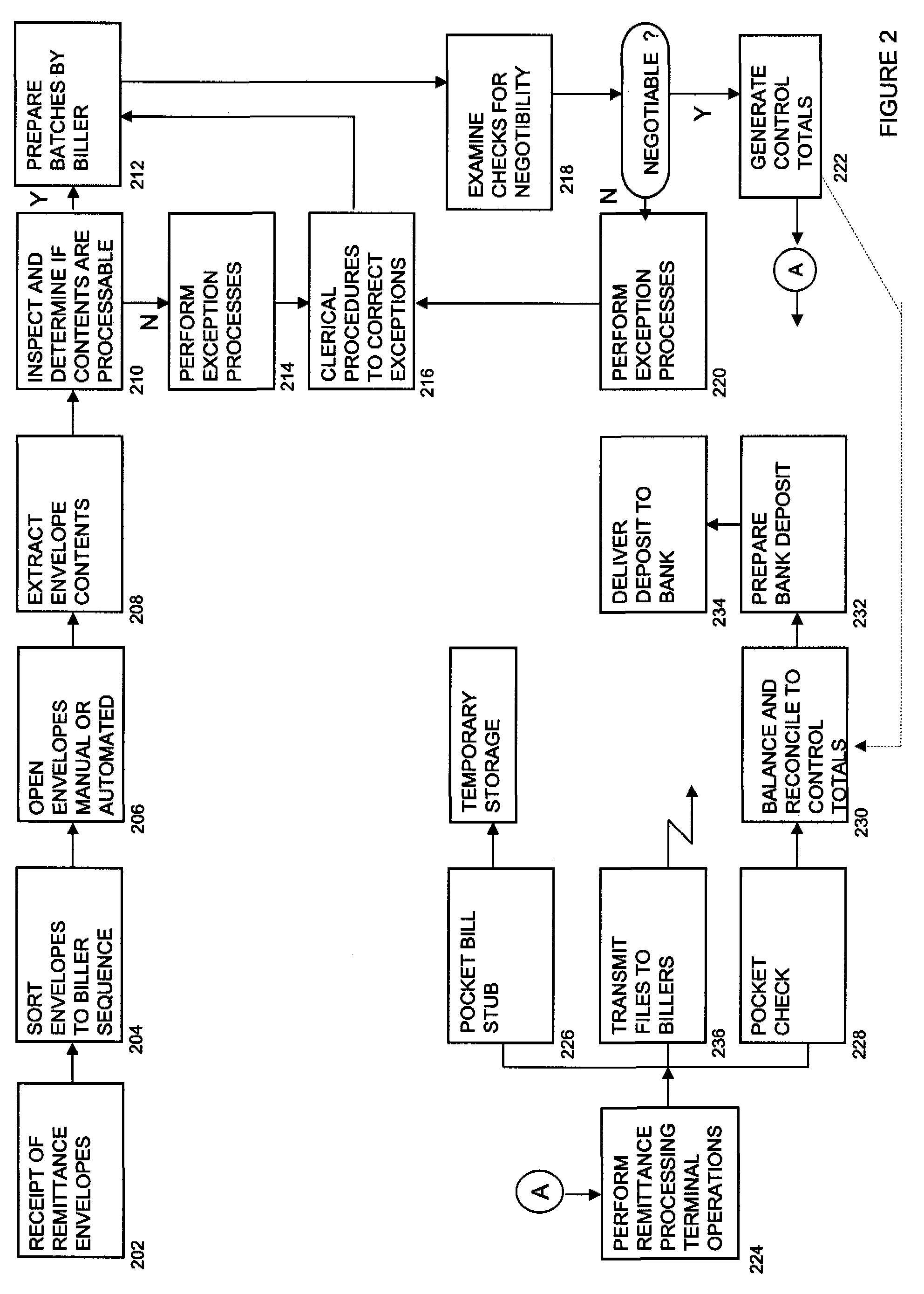

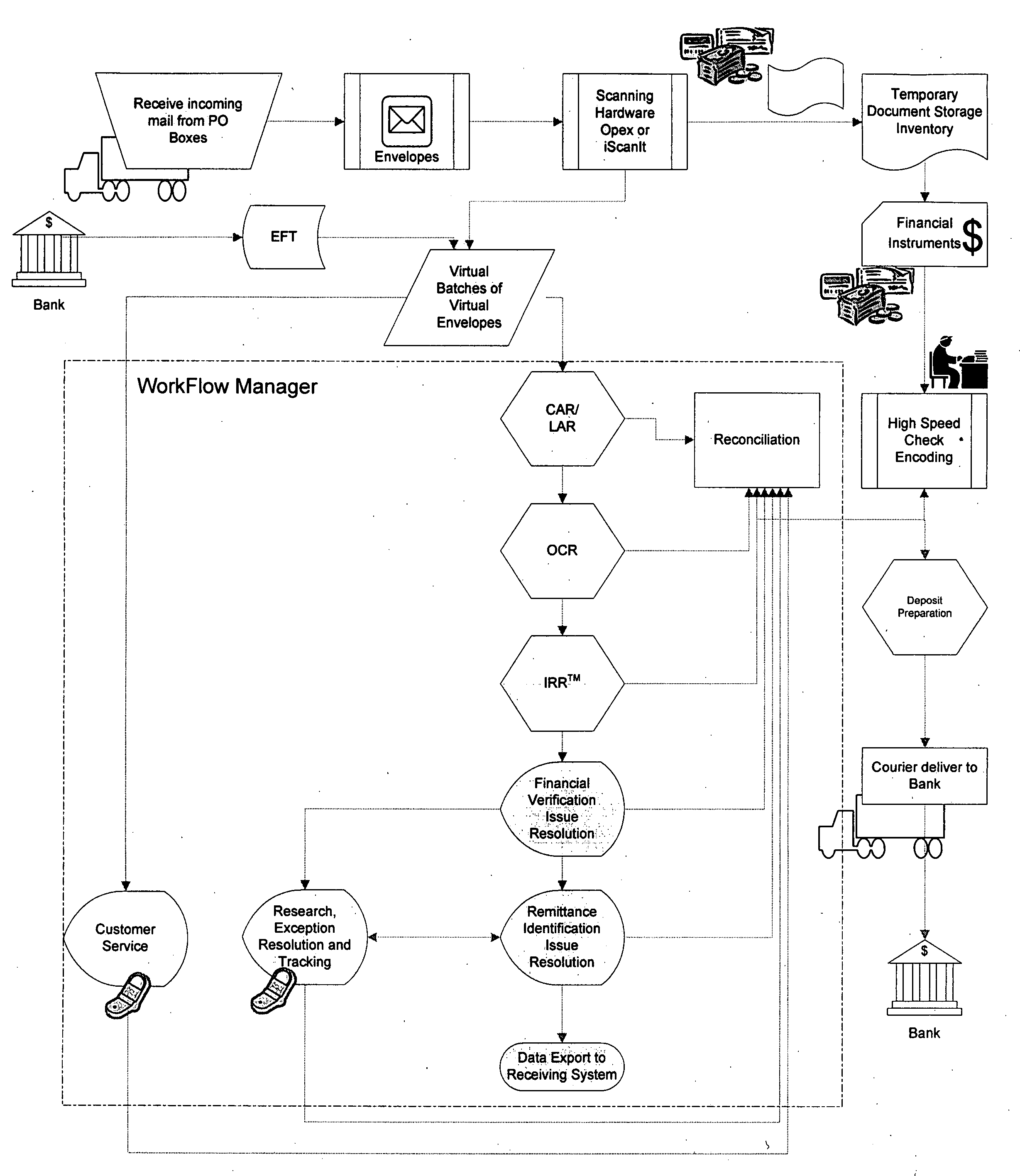

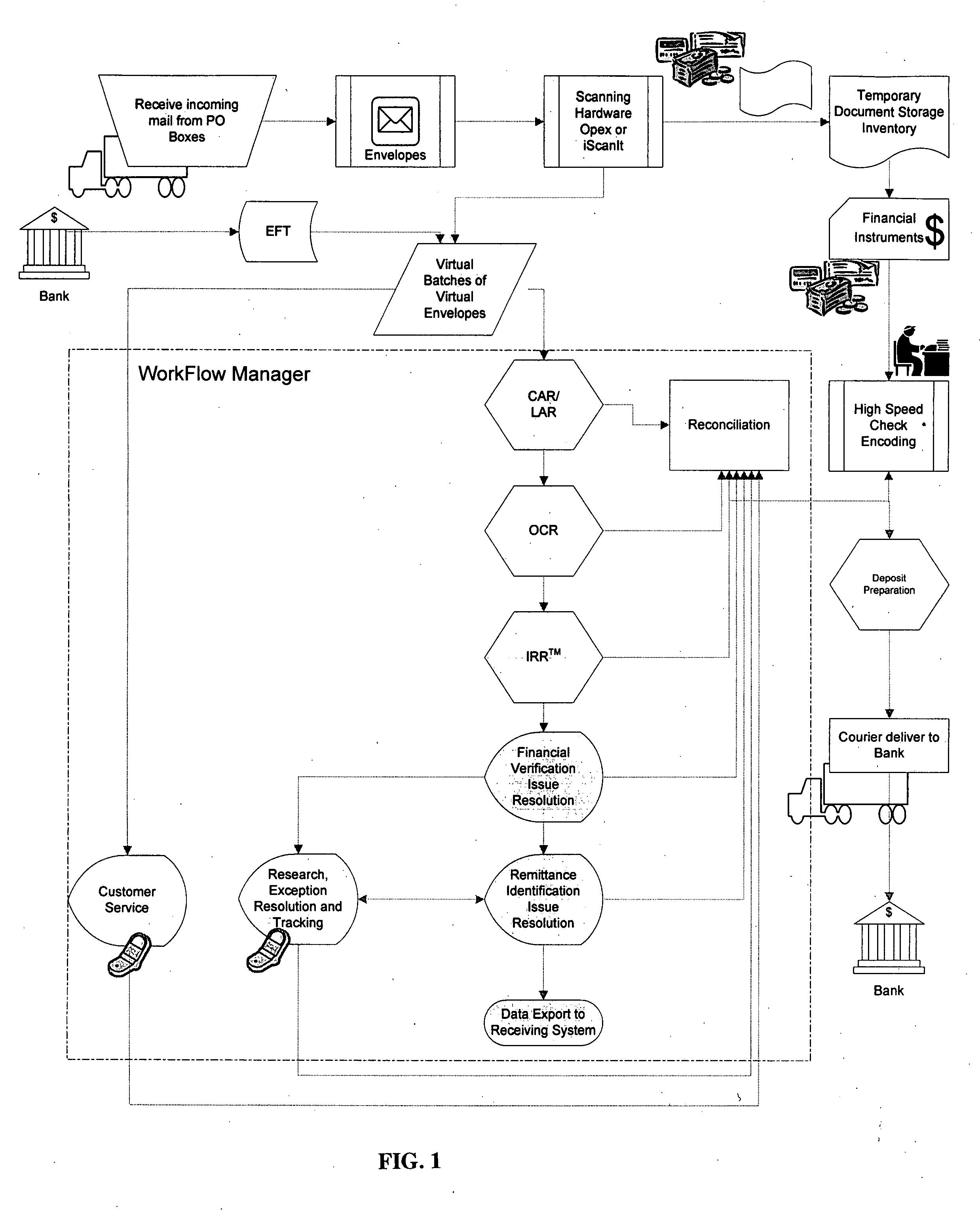

System and Method for Commingled Remittance Payment Processing

InactiveUS20050065893A1Improve productivityReduce equipment costsFinancePayment architectureDigital imageComputer science

A system and method for processing payment materials having at least one side with payment information, comprising providing a database having at least one electronic template having biller information specific to a biller, scanning the side of the payment materials to create a digital image, parsing the digital image for the payment information; and matching the payment information with the biller information.

Owner:THE ALLIANCE GROUP OF TEXAS

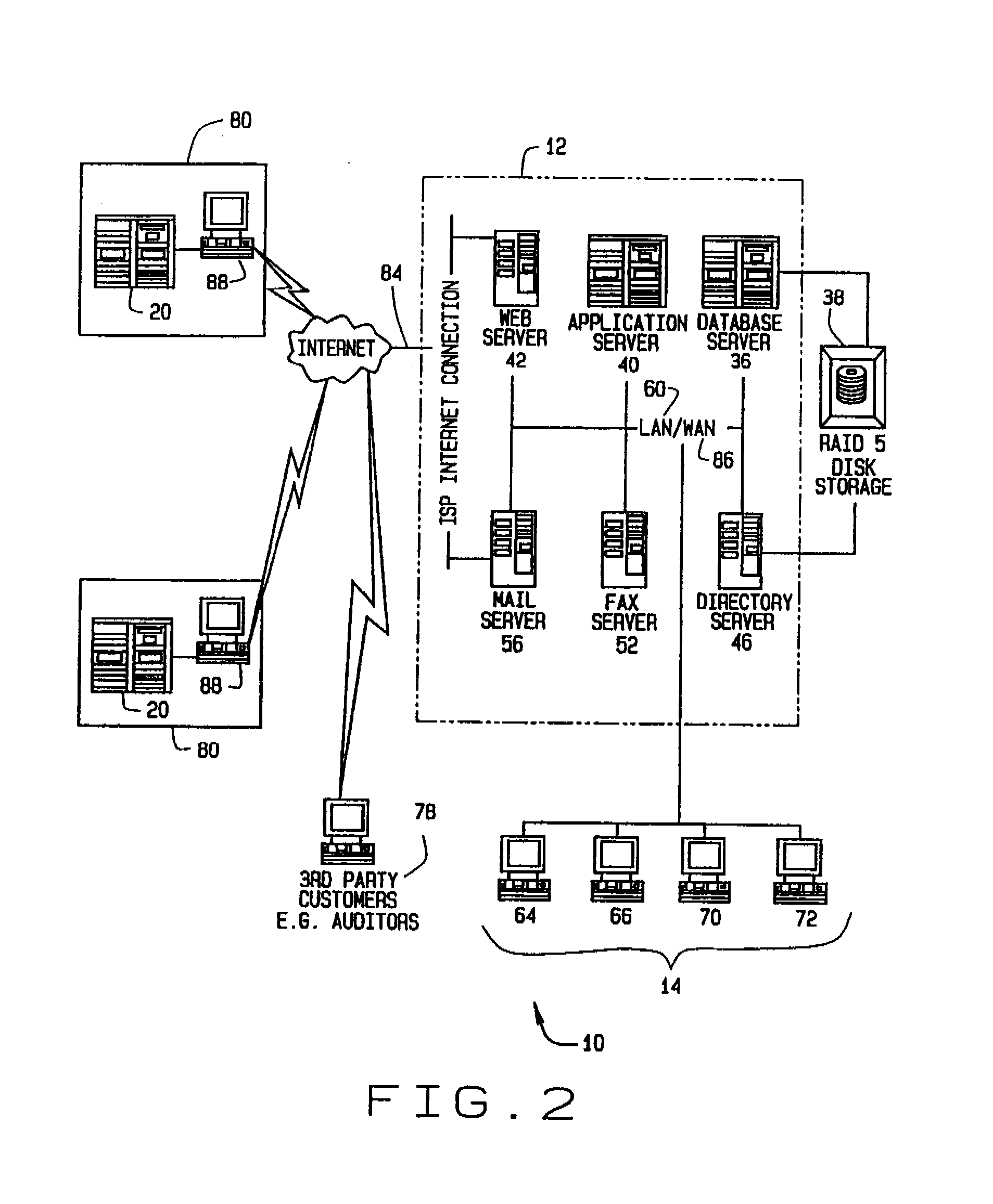

Method and system for processing payments

A payment processing method and system is described which involves serially processing remittance documents, e.g. financial instruments, remittances, and associated documents obtained from diverse sources, electronically scanning the financial instruments and other remittance documents, thereby converting the information contained thereon into a digital format. The digital information is passed through a series of software programs and associated hardware that read the scanned financial instruments, remittances, and other documents, and compares the information obtained with preexisting information about the payor, detects errors, and the like automatically, with minimal human intervention. It also allows the information to be corrected and passed to a check encoding machine or process which imparts desired information on said checks before they are sent to a bank for deposit.The system is a plurality of electronically interconnected machines and computer servers having unique software programs installed therein, thereby allowing the remittances, financial instruments, and other documents to be processed automatically with a minimum of human interactions.

Owner:INFORMATIX

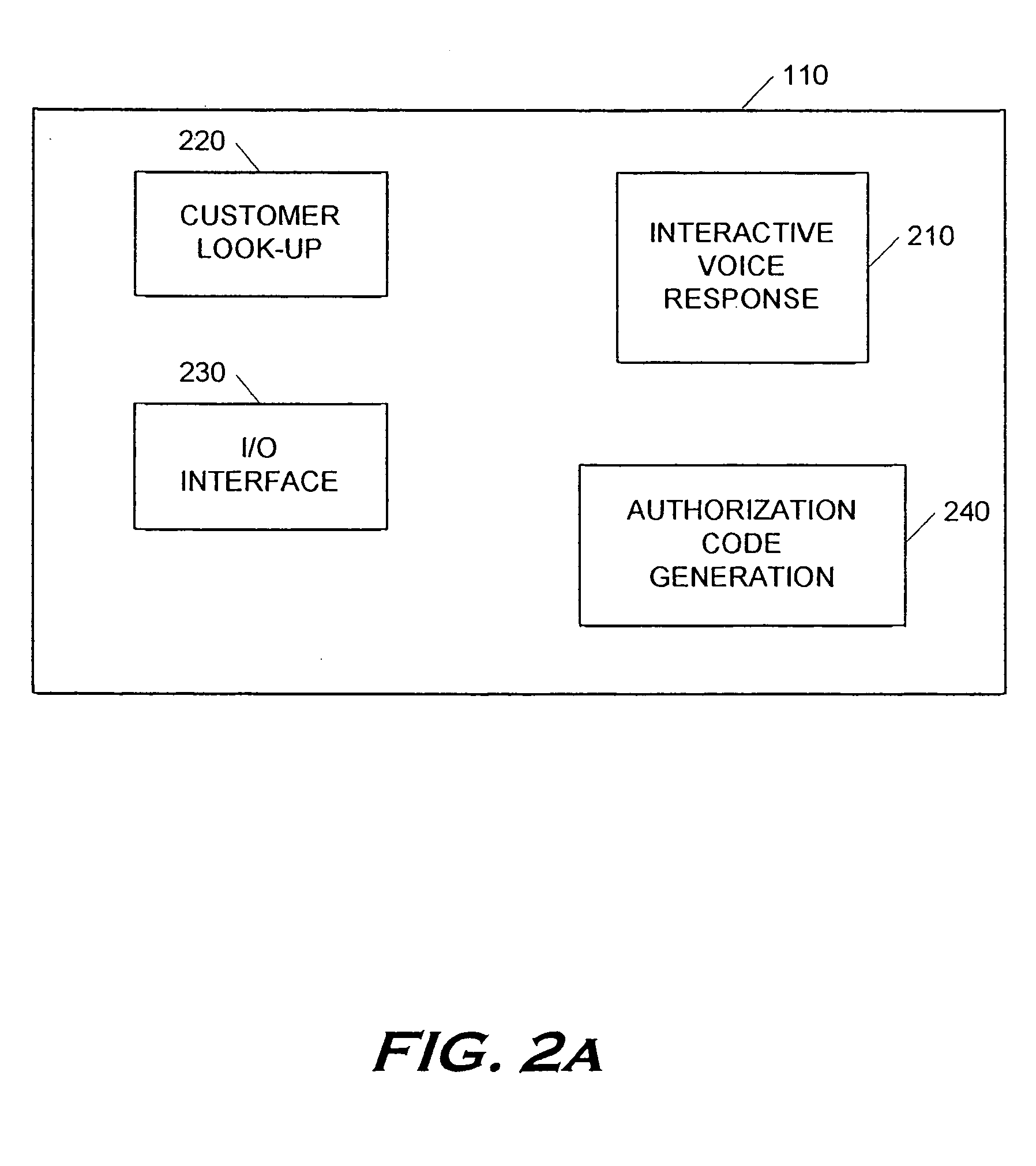

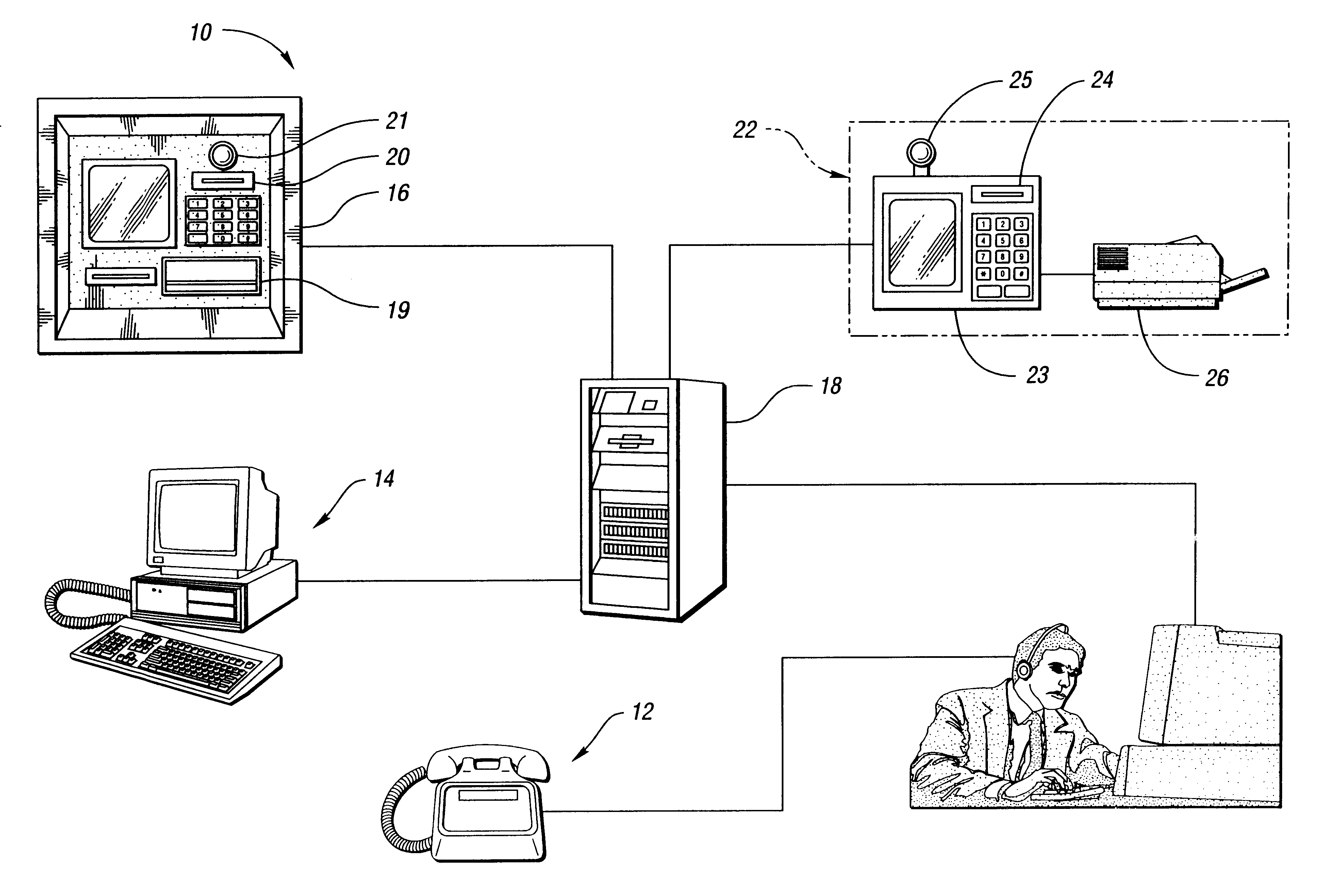

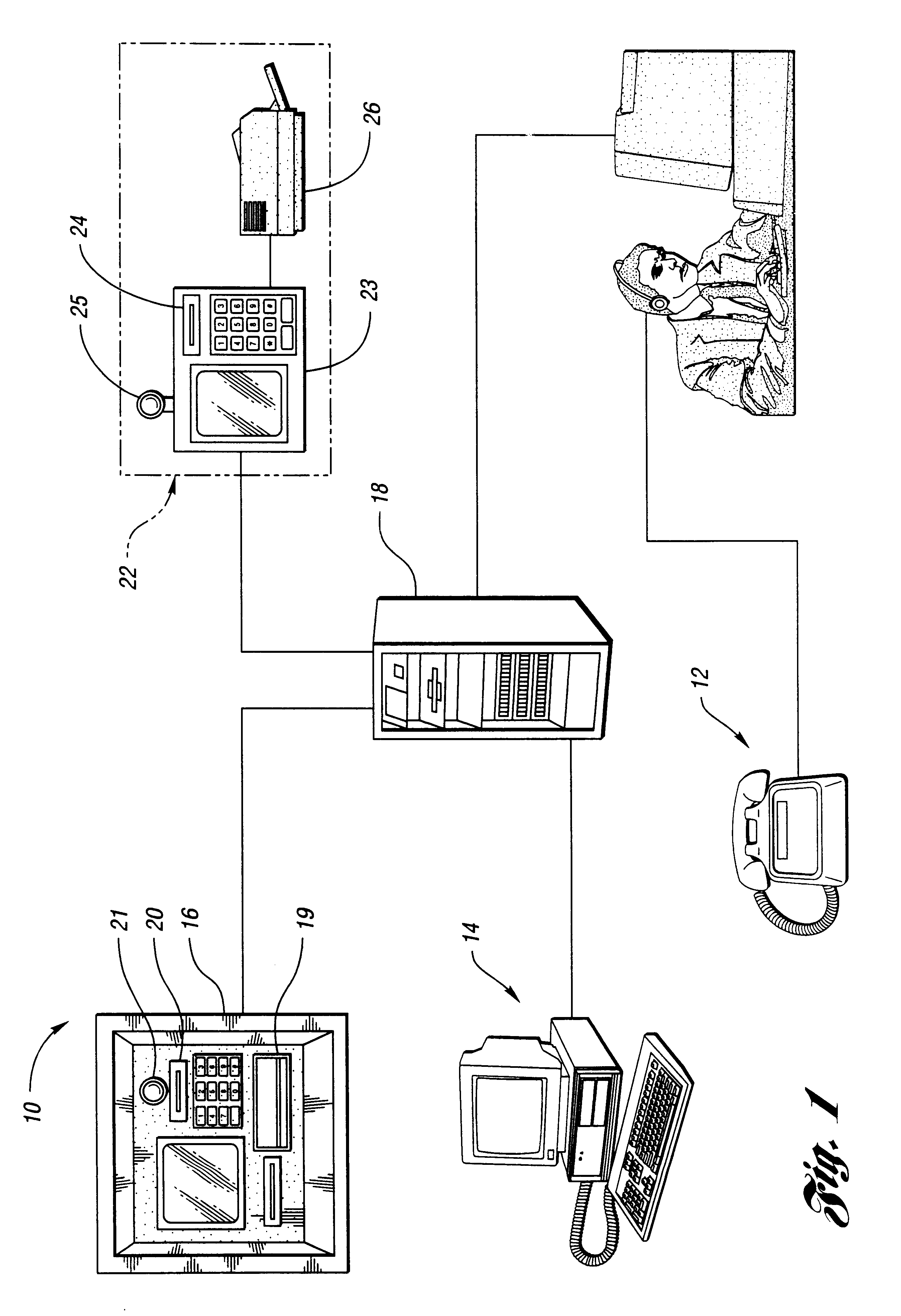

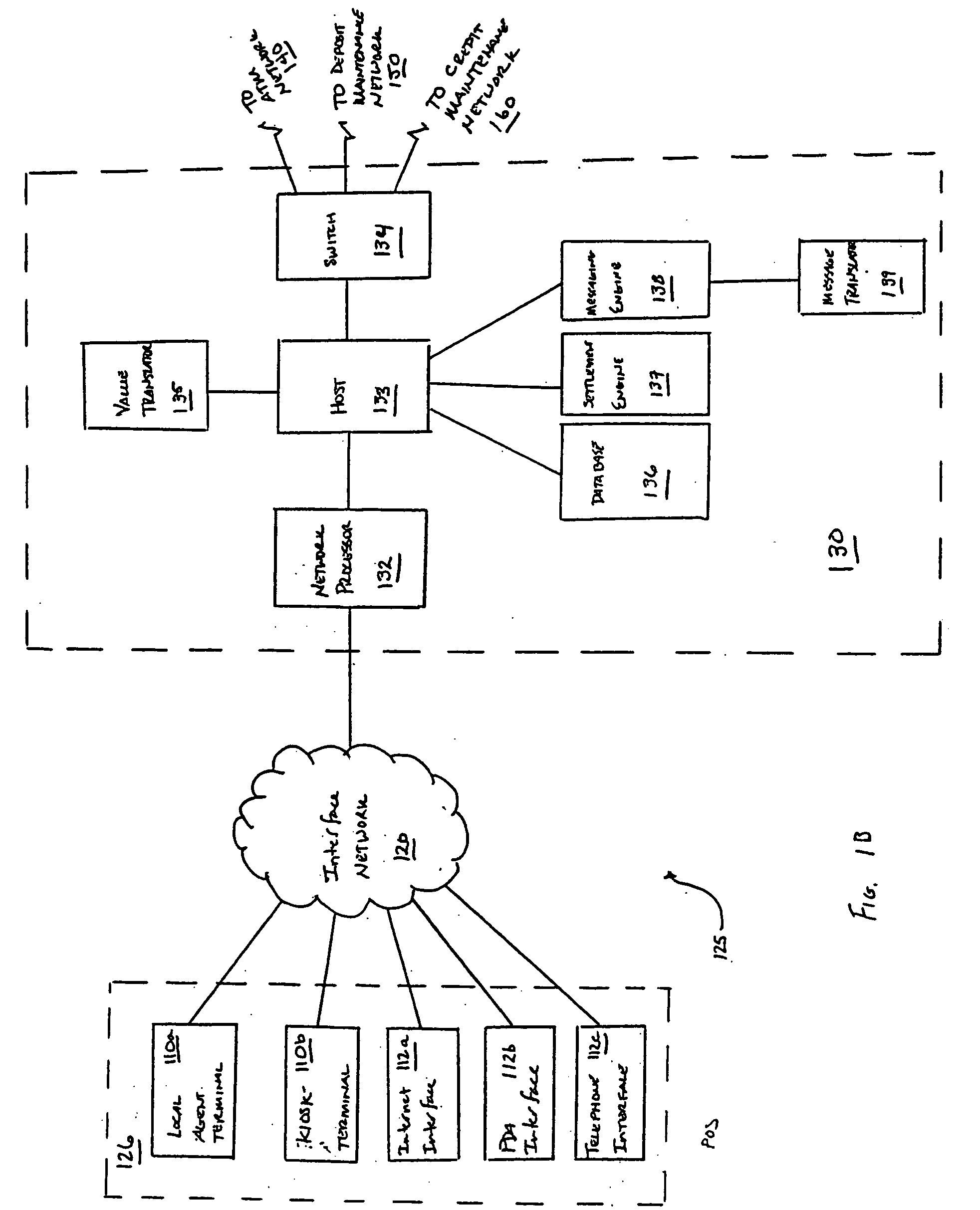

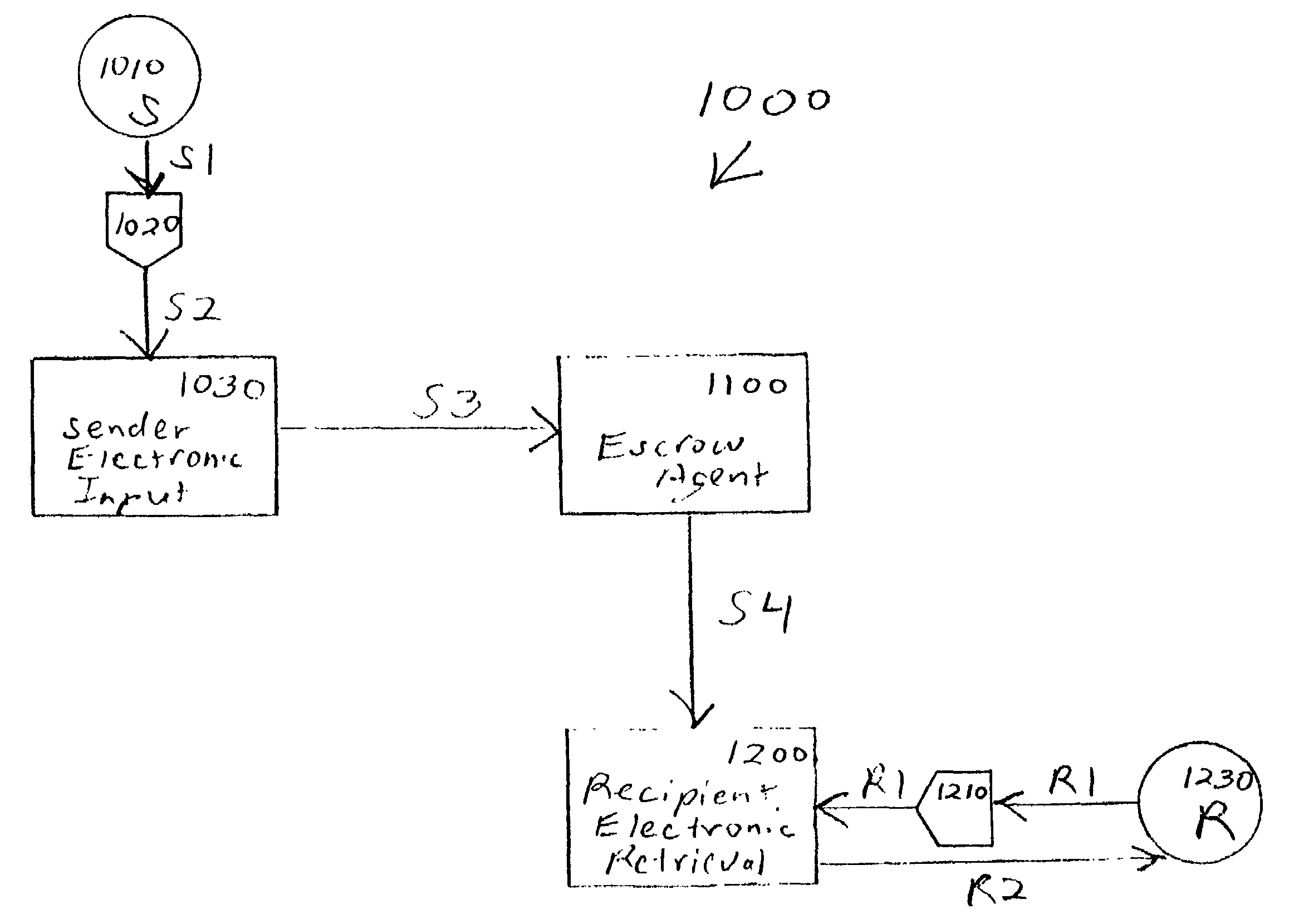

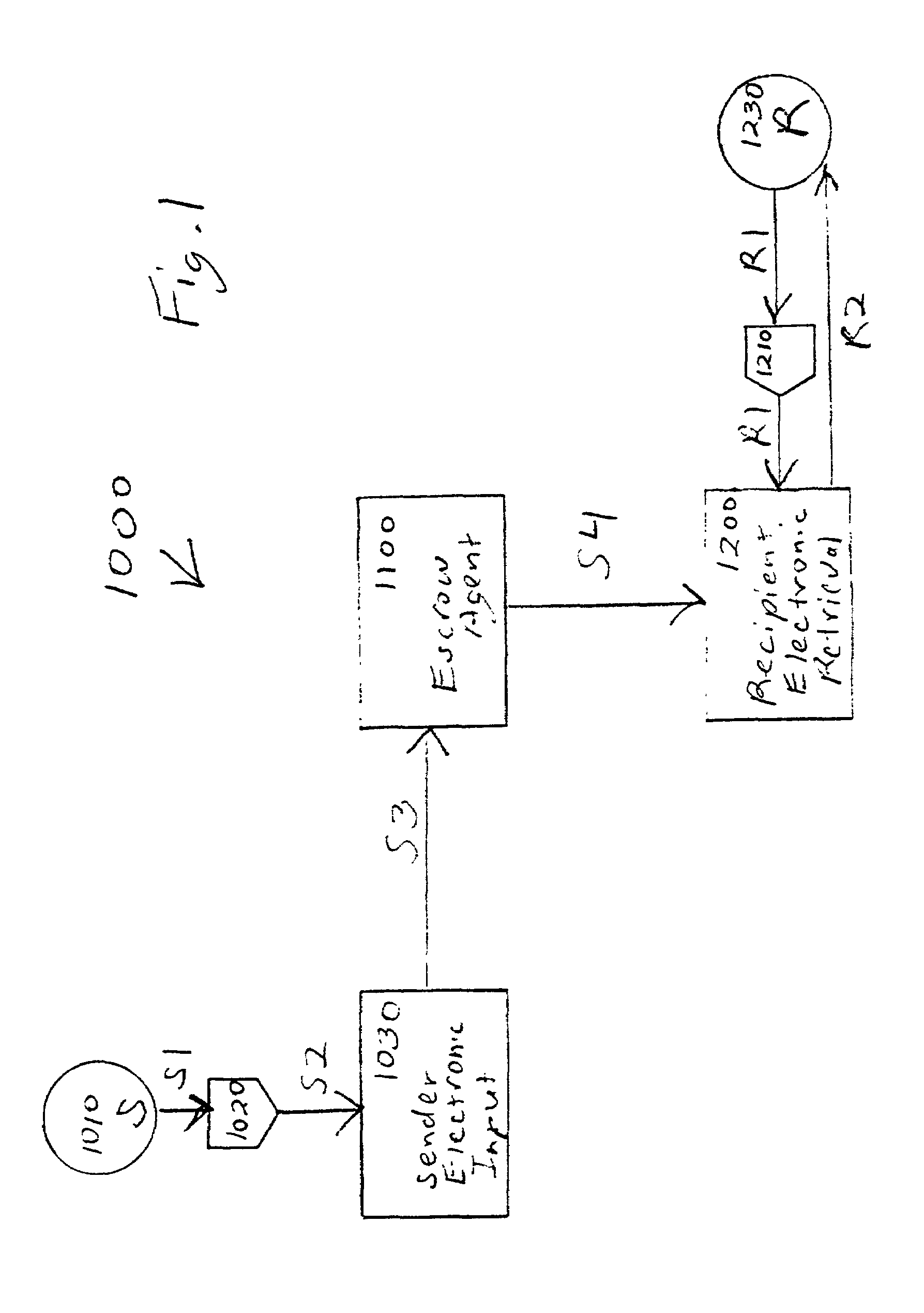

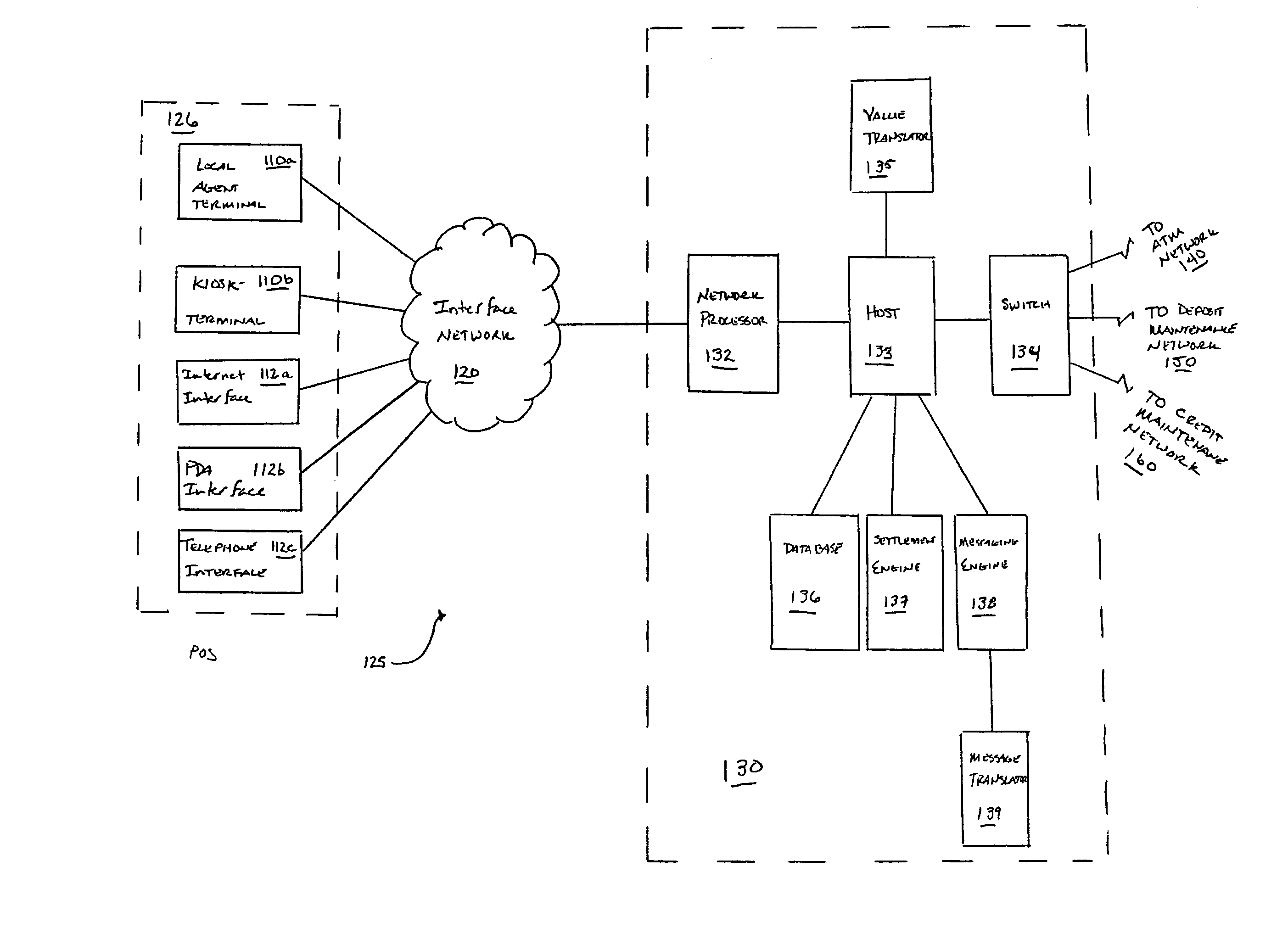

Integrated technology money transfer system

InactiveUS7415442B1Low costFinanceSpecial service for subscribersModem devicePersonal identification number

Money transfer system authorizing an escrow agent computer electronically by touch-tone telephone, computer modem, P.O.S.(point of sale) terminal, live operators, to send cash transfers from a sender's account such as their credit, debit, bank, or ATM card, or a bank account, to a recipient who accesses the money at any remote ATM type location or P.O.S.(point of sale) terminal by using cards such as a specialized magnetic cards, credit cards, debit cards, and automated teller machine(ATM) card, at anytime and anywhere. Senders can authorize the transfer by touch-tone and PIN(personal identification number) secure codes. The system can operate without pre-existing relationships, and monitor transactions and take surcharges based on transfer amounts, and use a cards tethered to ATM machines and be used with double magnetic sided cards.

Owner:INTEGRATED TECHNOLOGICAL SYST

System And Method For Transferring Money Based On Approval Of Transfer Request Transmitted From Receiver To Sender

A money transfer system transfers money based on approval of a sender for a transfer request transmitted from a receiver. This system includes a receiver terminal for transferring transfer request information including receiving information and sending information; a bank server for extracting the sending information from the transfer request information to guide the transfer request information to a sender, and transferring an amount of money from a payment account of the sender to a deposit account when the sender checks the transfer request information and approves the money transfer; and a sender terminal for accessing the bank server to receive and display the transfer request information, and transmitting an approval for the money transfer to the deposit account. The sender determines whether or not to transfer money by checking the transfer request of the receiver, thereby reducing time taken for the money transfer process and enhancing accuracy and safety.

Owner:KIM YOUNG SU

Derivative currency-exchange transactions

Methods are provided for executing a money transfer from a first party to a second party. Customer instructions are received at a host system to stage the money transfer. The instructions include specification of an amount of money to be transferred, specification of a first currency in which the funds are to be provided by the first party, specification of a second currency different from the first currency in which the finds are to be received by the second party, and specification of a trigger currency exchange rate. Confirmation is received that the finds have been collected from the first party. A currency exchange rate between the first currency and the second currency is monitored. It is determined whether the monitored currency exchange rate is at least as favorable for the first party as the trigger currency exchange rate.

Owner:FIRST DATA

Method and apparatus for exact calculation of gambling game fee

InactiveUS20040053693A1Data processing applicationsApparatus for meter-controlled dispensingSimulationClient-side

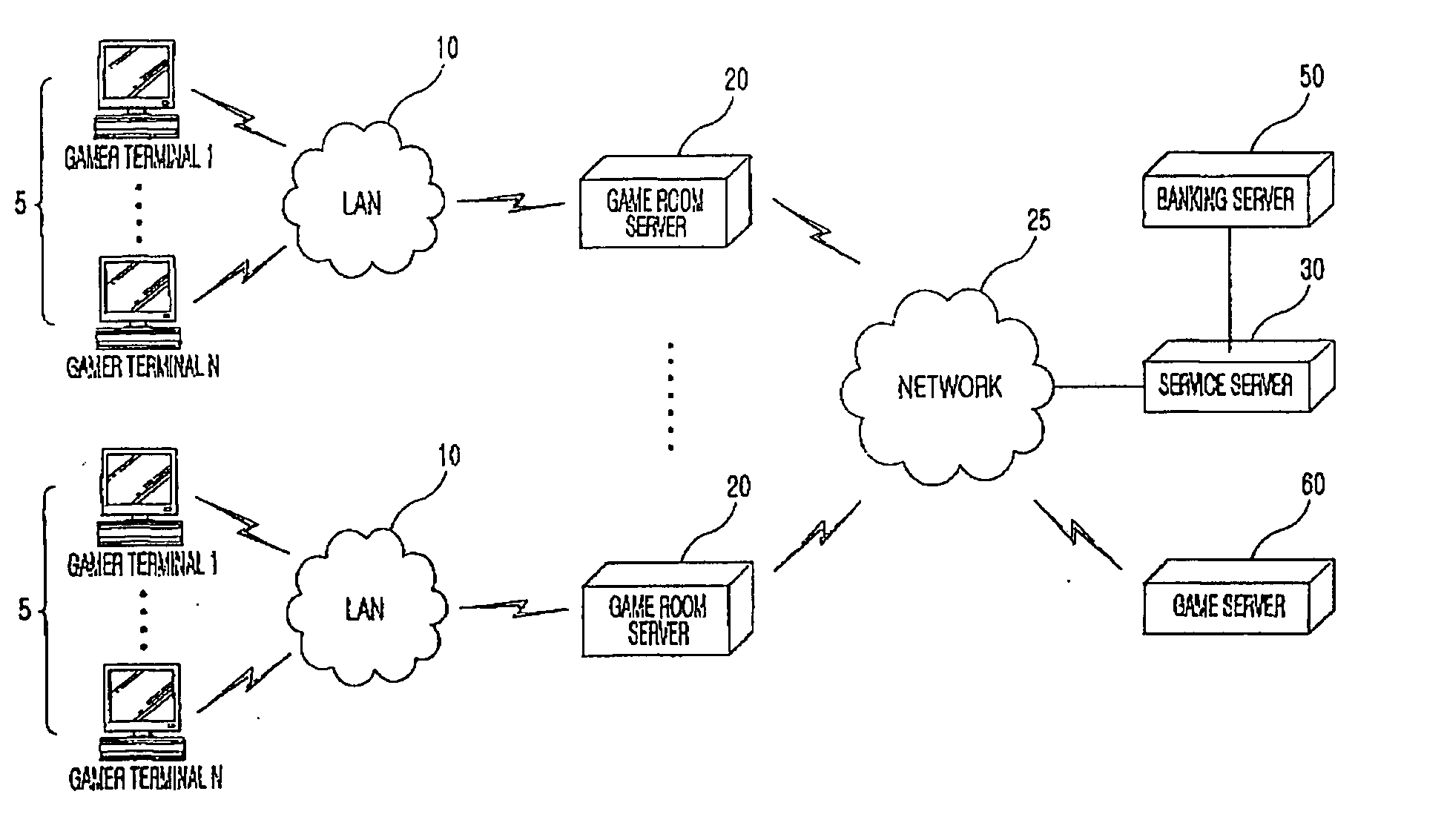

The method for calculating a game fee depending on victory or defeat of a user in a gambling game played through at least two client PCs connected in one or more networks in which a plurality of client PCs are connected to one management server computer, includes the steps of opening a real account and a corresponding virtual account, processing game among gamers, calculating a game fee depending on victory or defeat of each gamer, transferring money from a virtual account of winner to a virtual account of loser, checking a breakdown of the real account with the balance of the virtual account, and instructing money transfer between the real accounts based on the breakdown.

Owner:AN GI JU

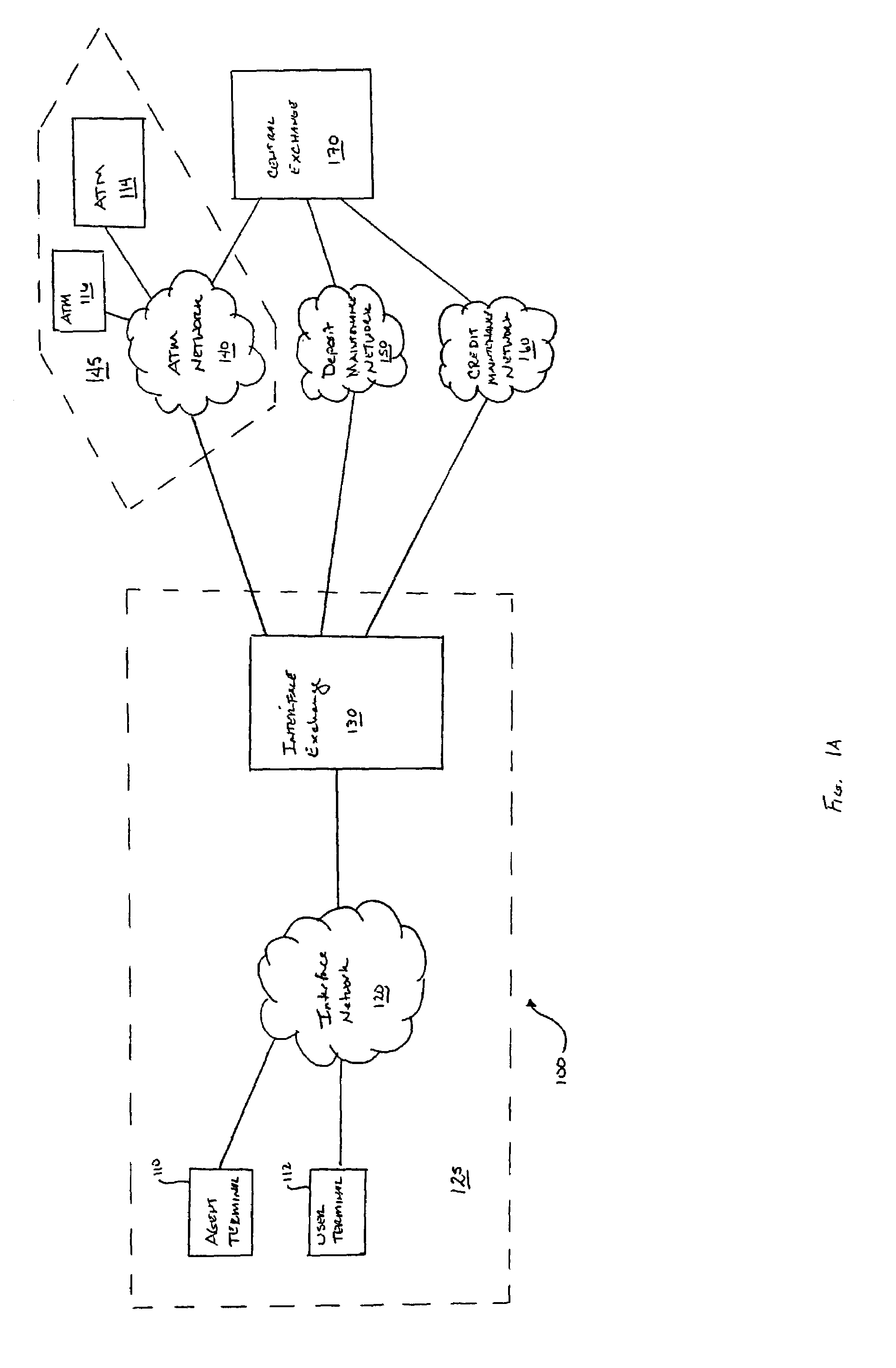

Money transfer systems and methods for travelers

InactiveUS7104440B2Easy transferEfficient receptionComplete banking machinesFinanceComputerized systemRemote computer

One method involves payment of money to a recipient traveling to one or more foreign countries by entering into a remote computer money transfer information from a sender. The money transfer information comprises recipient identification information, at least one country where the money is to be received, and a payment amount in an originating currency. The money transfer information is transmitted to a host computer system. When ready to receive payment in the designated country, recipient identification information along with a request to withdraw a portion of a possible payment amount is entered into a payout computer. The recipient identification information and the request to withdraw is transmitted to a host computer system, and the requested withdrawal is provided to the recipient in the local currency.

Owner:THE WESTERN UNION CO

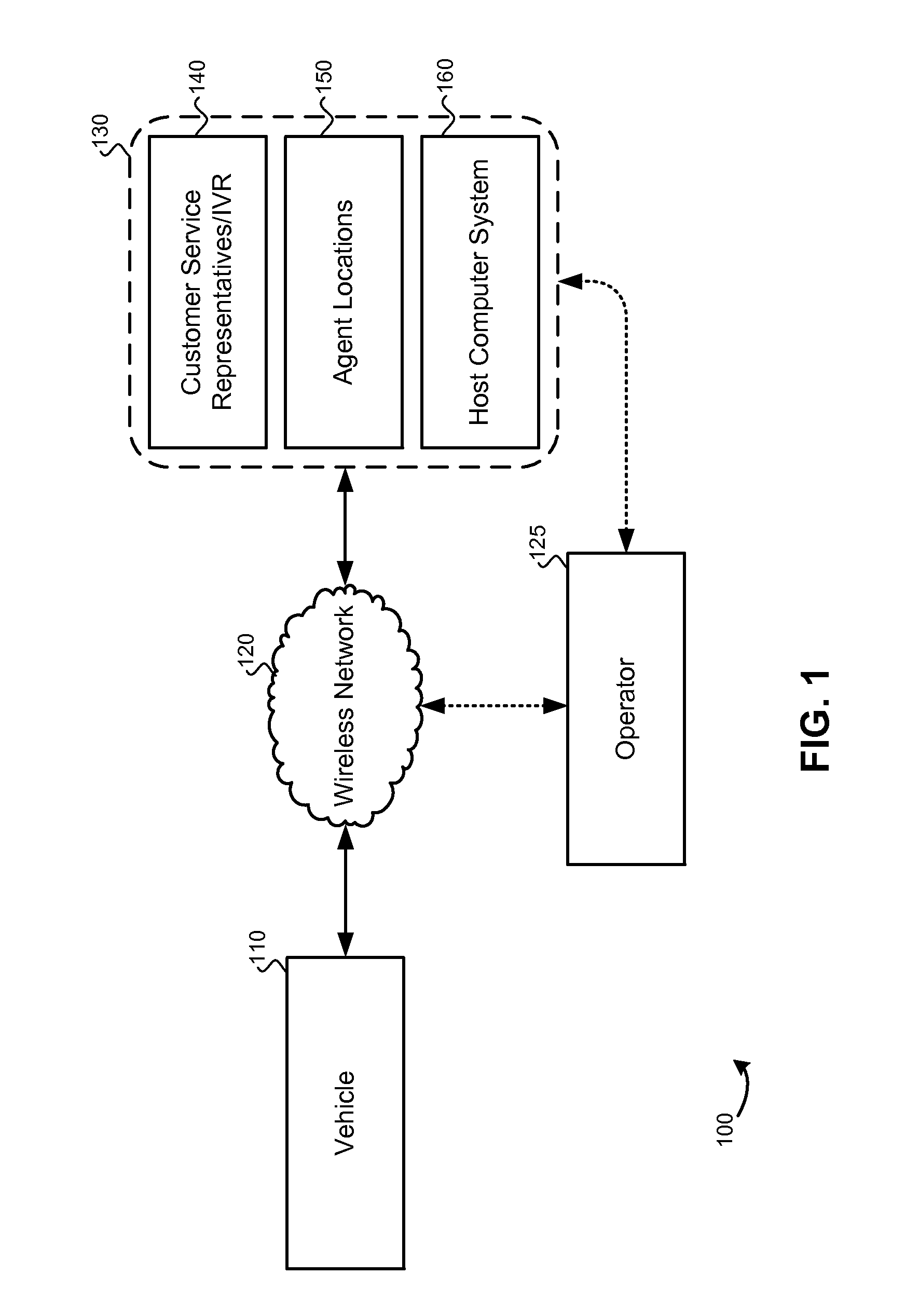

Vehicular-based transactions, systems and methods

ActiveUS20110231310A1Digital data processing detailsUser identity/authority verificationOn boardUser input

Various systems and methods are described for conducting and staging money transfer transactions from a vehicle. The systems and methods may include using a wireless transmitter on board the vehicle for wirelessly communicating with a money transfer system. Also, a user-input device integrated with the vehicle's navigation system, entertainment system, and / or climate system may be used. Using the wireless transmitter, the user-input device may interface with the money transfer system. Also, one or more identity authentication devices may be integrated with the vehicle that collect information to authenticate a user's identity.

Owner:THE WESTERN UNION CO

Money transferring method and device based on block chain, and storage medium

ActiveCN108846659AImprove transfer efficiencyWill not interfere with each otherPayment architectureChain networkDistributed computing

The invention discloses a money transferring method based on a block chain. The method comprises the following steps of traversing a received transaction queue of a block to reach a consensus, and judging whether currently traversed transactions meet a parallel execution condition; if the transactions meet the parallel execution condition, executing the transactions in parallel, and otherwise, executing the same serially; when all transactions in the block transaction queue is completely executed, generating a Hash value of the block to be shared and broadcasting the same in a block chain network, so as to reach the consensus with other nodes in the block chain network; and when the consensus is achieved with the other nodes in the block chain network, recording transaction execution results of all transactions in the block to reach the consensus into a block chain. The invention also discloses a money transferring device based on the block chain and a computer readable storage medium.According to the method, device and medium provided by the invention, the concurrent execution of the multiple transactions in the block chain is achieved, and thus the money transferring efficiencyis enhanced.

Owner:WEBANK (CHINA)

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com