Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

59 results about "Business Day" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Any day a government or commercial enterprise is open and actively engaged in the work of that enterprise.

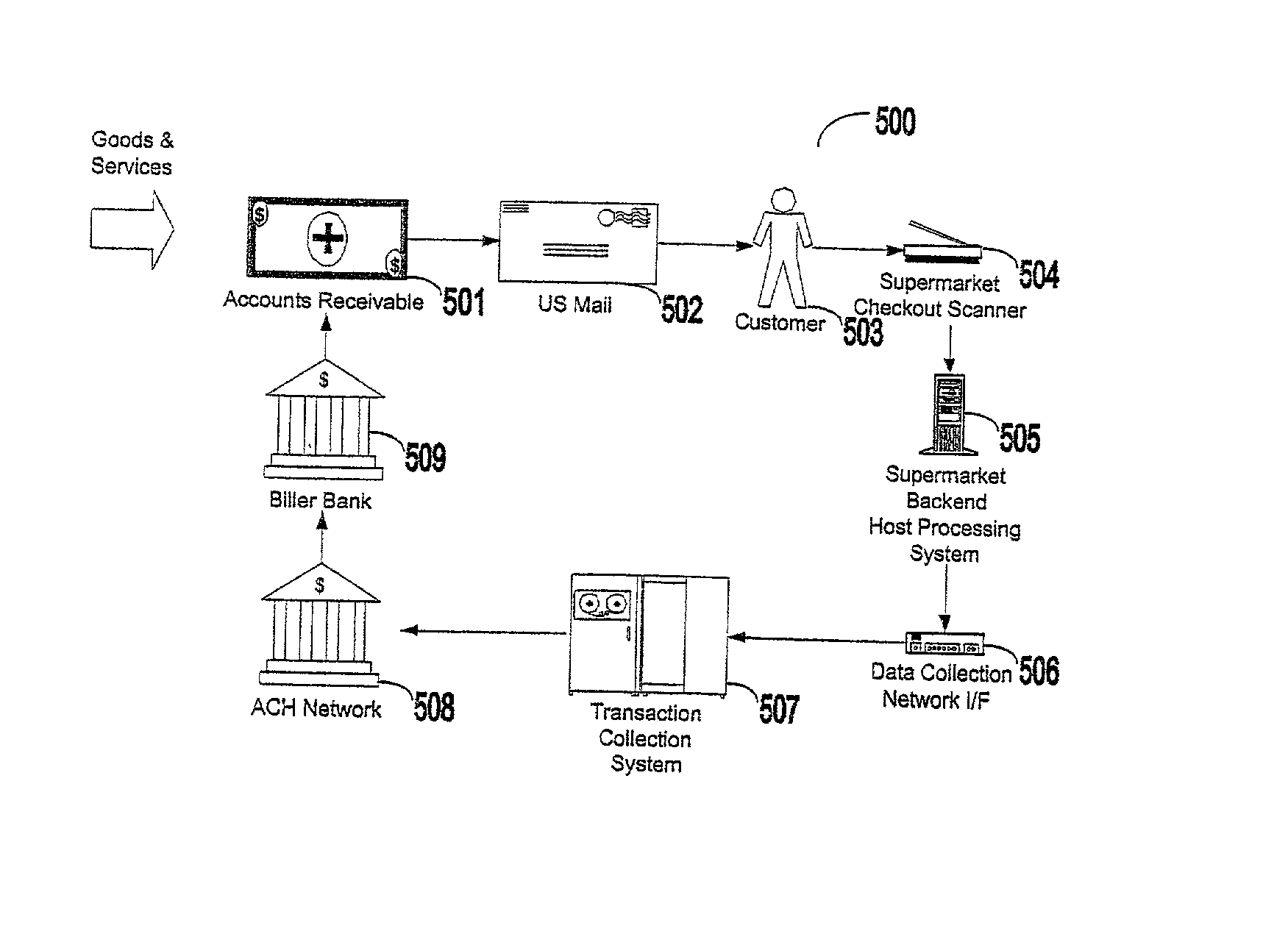

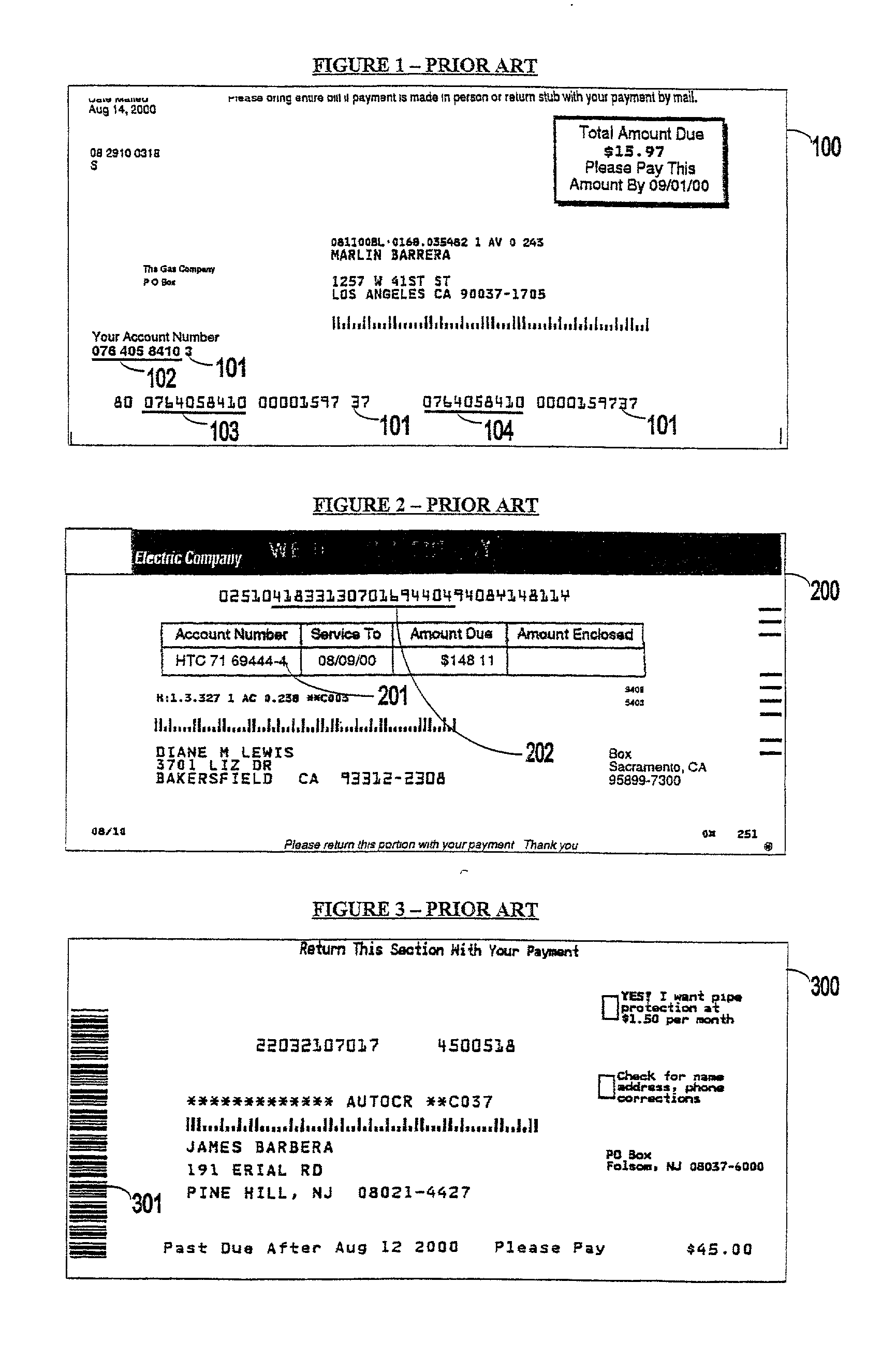

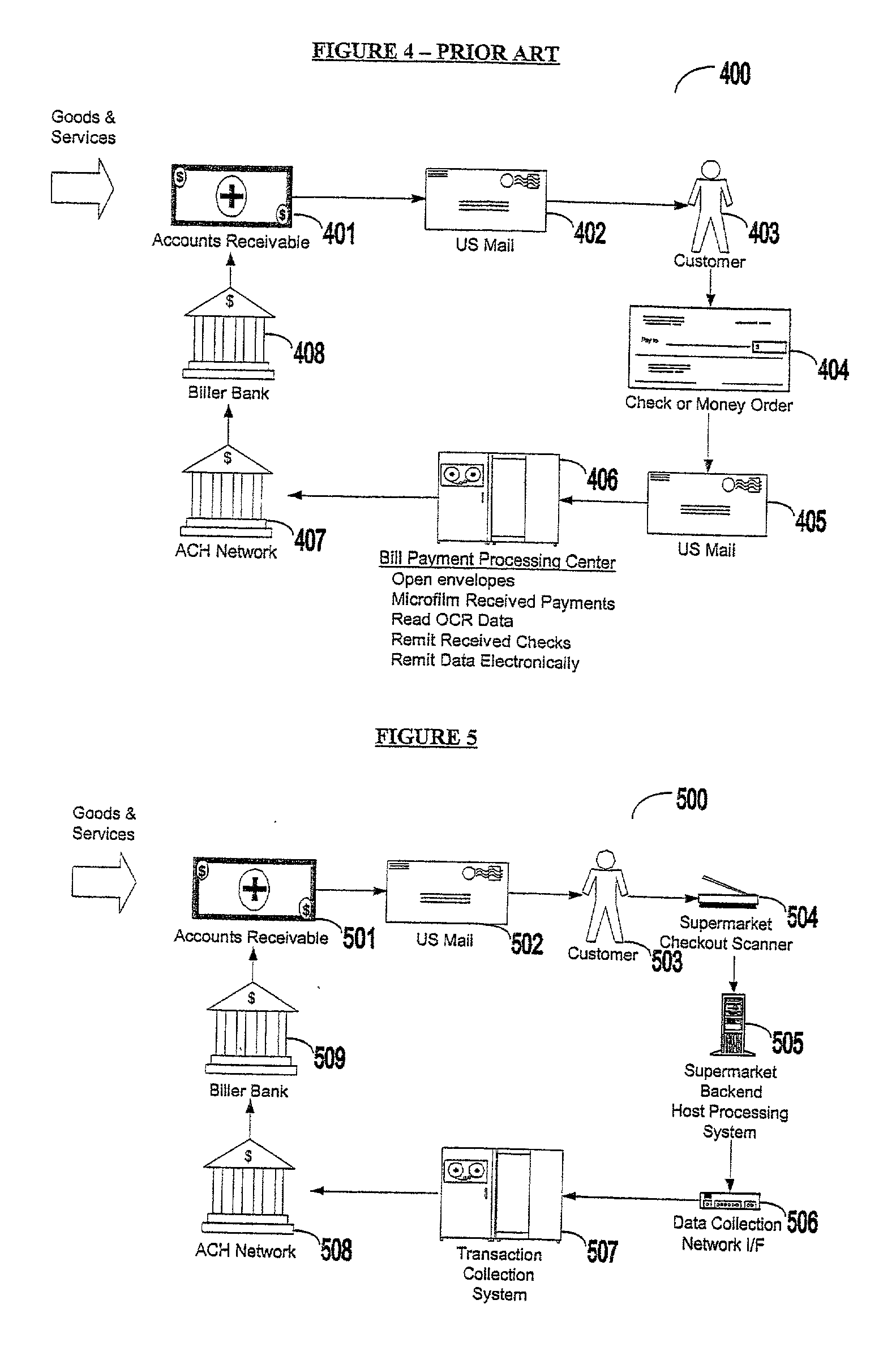

Bar coded bill payment system and method

InactiveUS20020128967A1Inexpensively and easily established and maintainedPay their bills more efficientlyFinancePayment protocolsBank accountBarcode

A system and method for payment is provided, wherein consumers pay their bills at supermarkets, large retail chain, or other stores and receive immediate credit from billers for their payments. Payments are made using a bar code printed on the bill or sent to the consumer, e.g., by fax or email. The biller receives good payment funds, deposited directly into his bank account, and error-free electronic payment data for consumer bill payments by the very next business day. The biller backdates the received bill payments to the time and date the consumer actually paid, regardless of the time that the payment data takes to post to the biller's accounts receivable system. In another aspect, a method for person-to-person money transfers is provided, wherein a bar coded deposit slip, card, or other printout permits a sender to remit finds directly into a receiver's bank account, and such funds are quickly accessible for withdrawal at a nearby automated teller machine, or for a debit card purchase.

Owner:PAYSCAN AMERICA

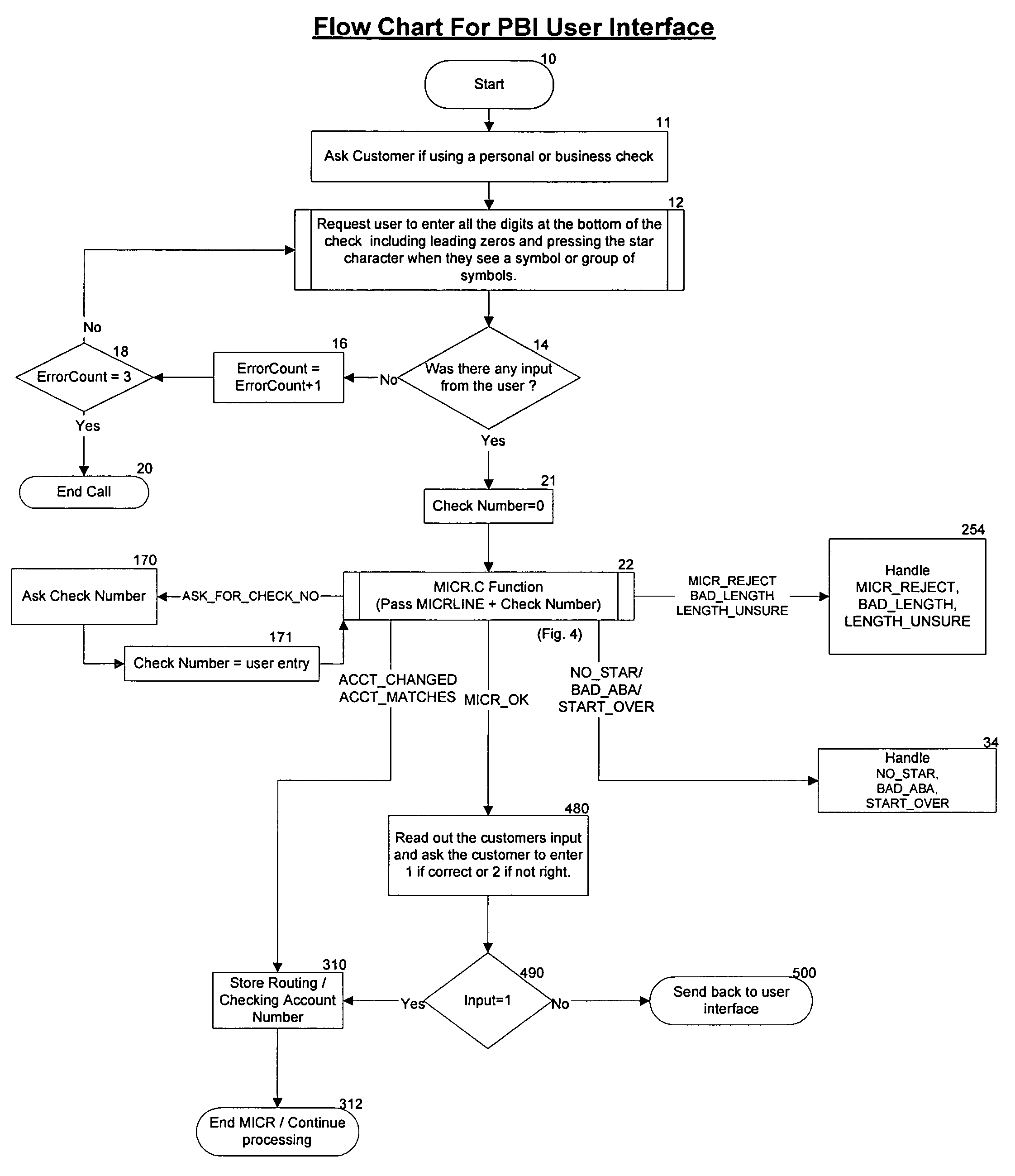

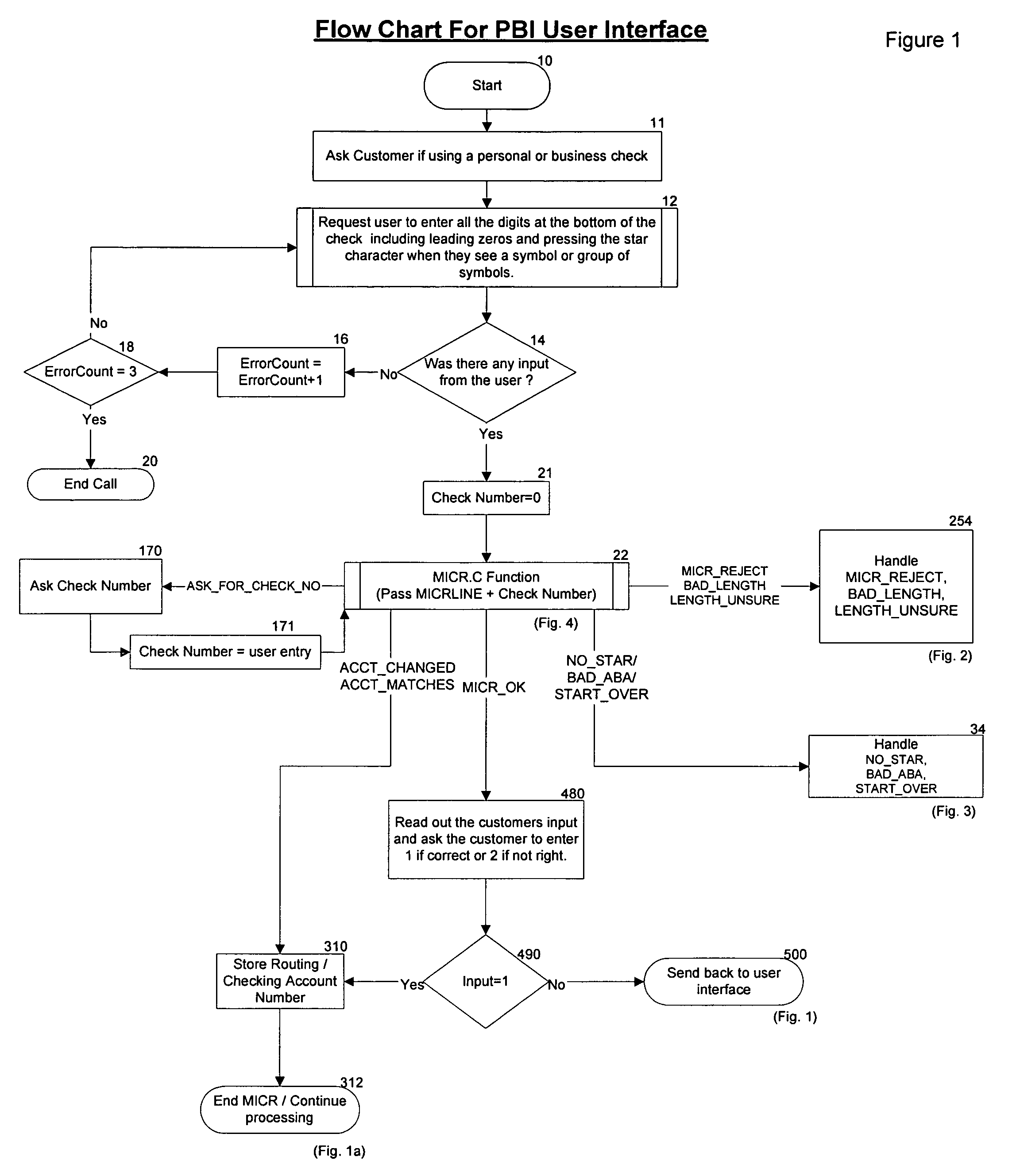

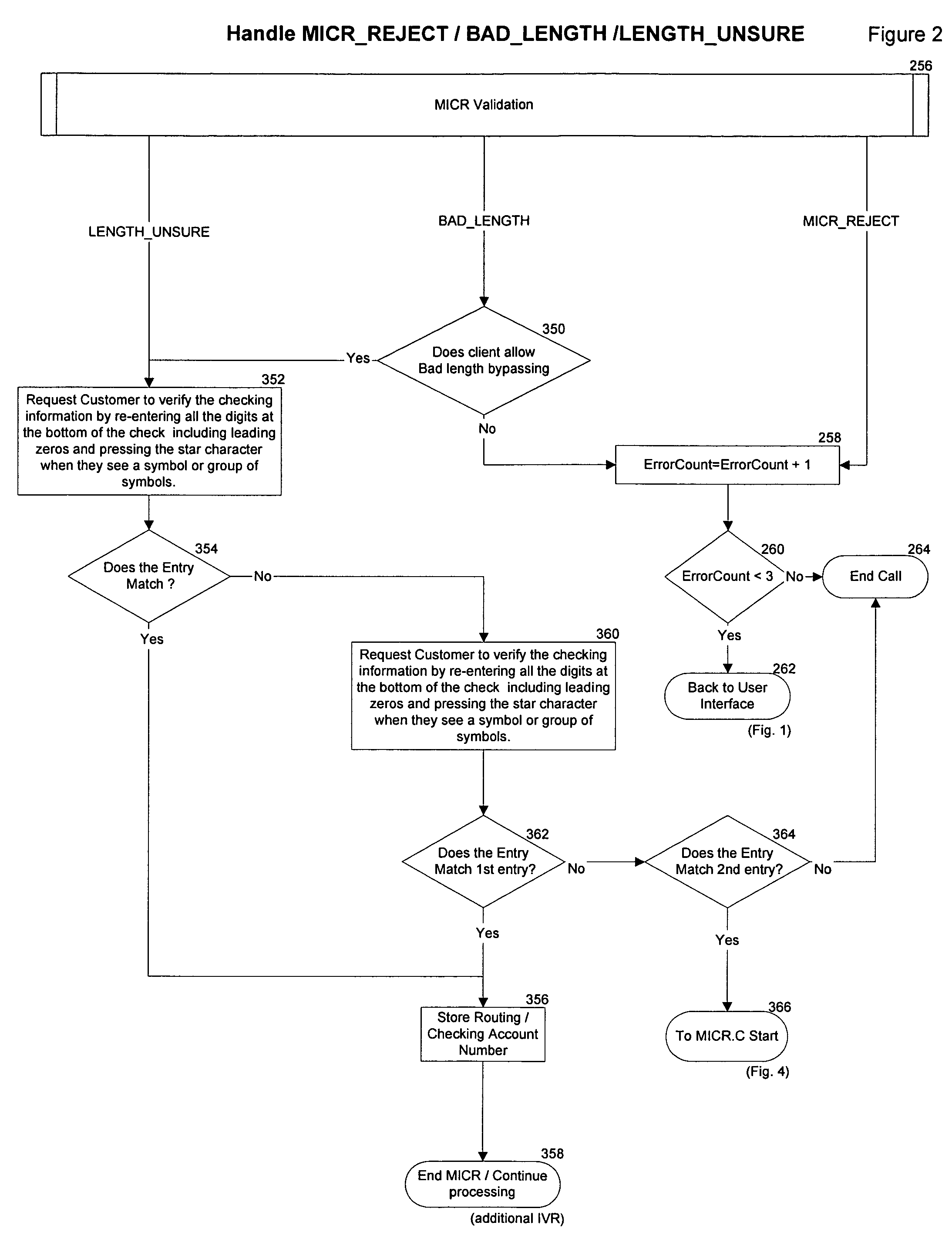

Methods and apparatus for processing electronic checks

InactiveUS7175074B2Reduce in quantityReduce NSF returnsComplete banking machinesFinanceChequeComputer science

Owner:CHECKFREE SERVICES CORP

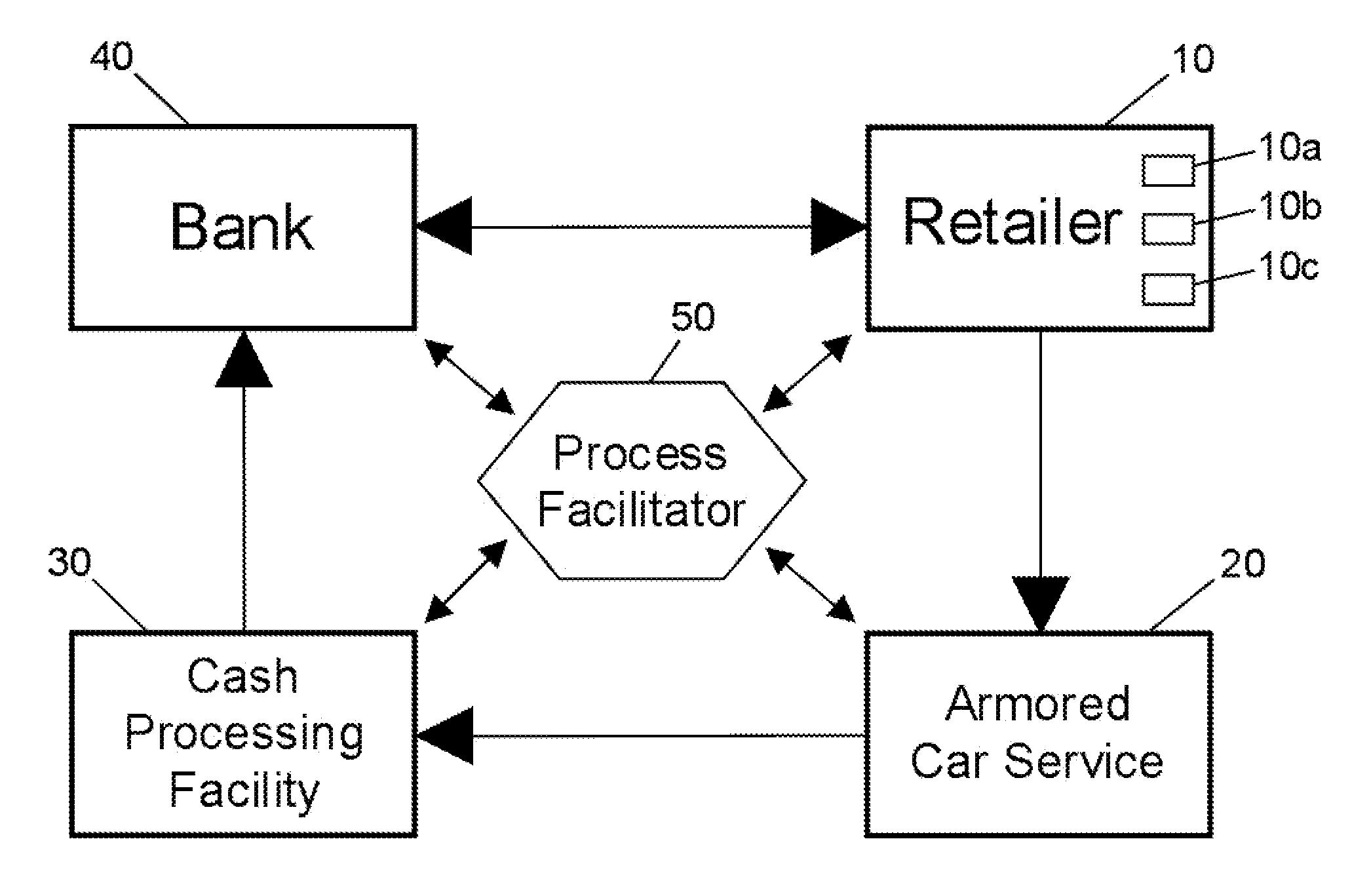

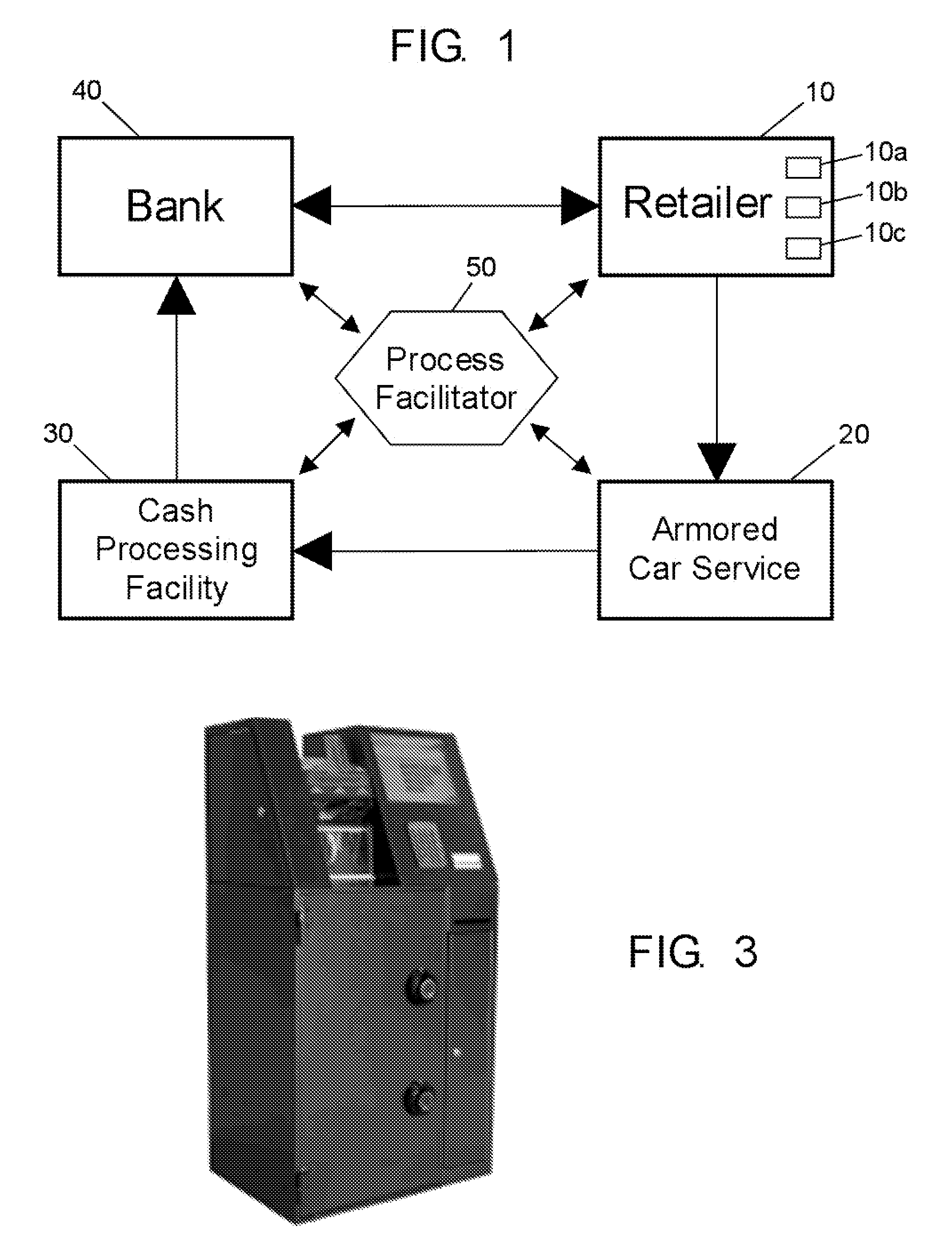

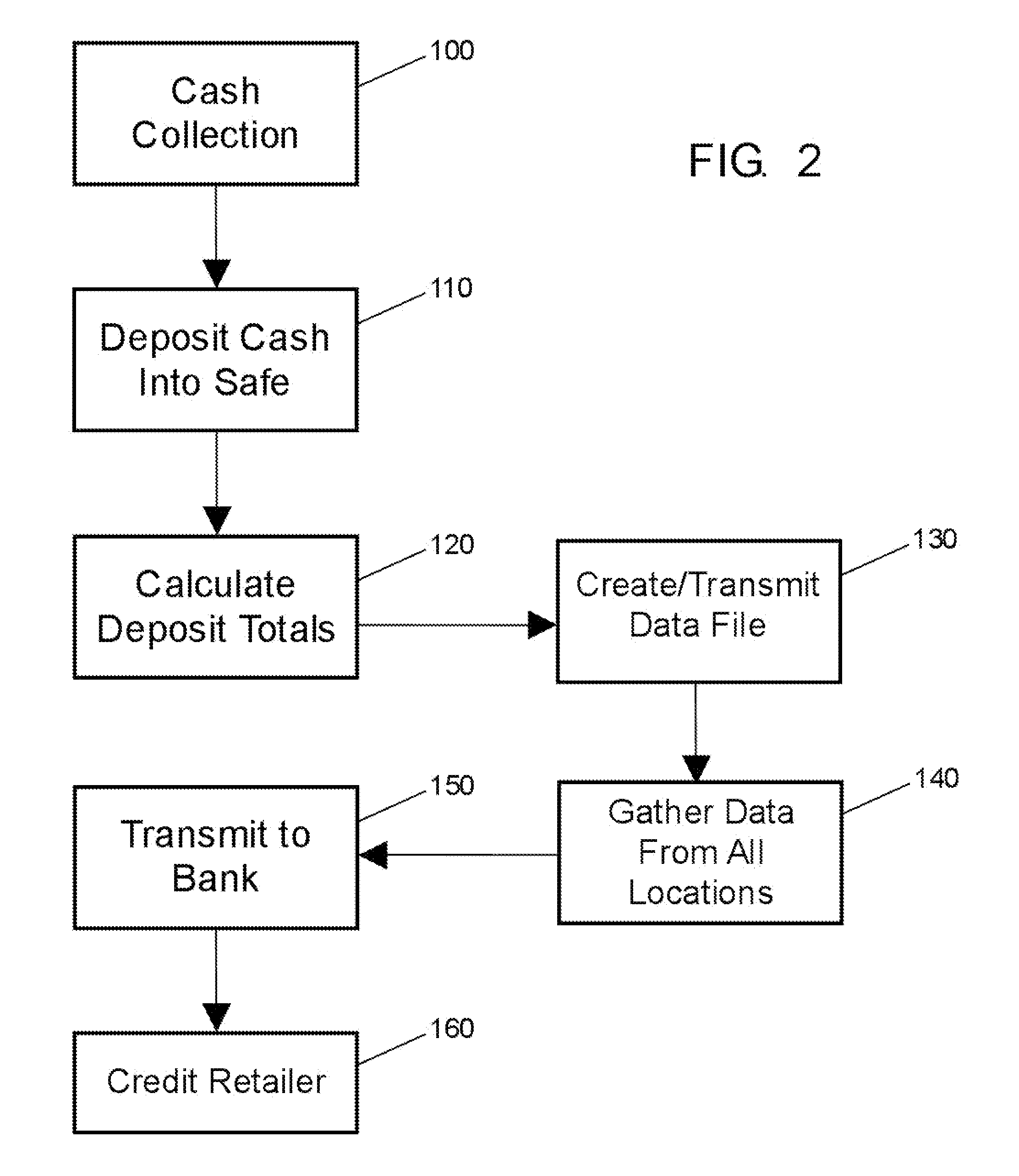

Process of and system for advancing credit for cash collections

A process for providing bank credit to retailers for cash collections that are carried out during retailers' normal business operations. The process entails a retailer collecting cash over a period of time, such as over a single or multiple business days, generally in exchange for goods and / or services, depositing the collected cash into one or more electronic safes disposed at the retailer's location or locations, calculating at a designated time, such as the end of day at each location, a total amount of cash that has been deposited into the retailer's safes over such period of time, and electronically transmitting data files that identify the calculated total amounts of cash accepted by the retailer over the period of time. The retailer is credited, for example, by a bank, with the total cash deposits as reported by the electronic safes at the end of each business day. The process advantageously makes funds readily available and improves cash flow to retailers who take-in cash as part of their normal business operations.

Owner:BRINKS NETWORK

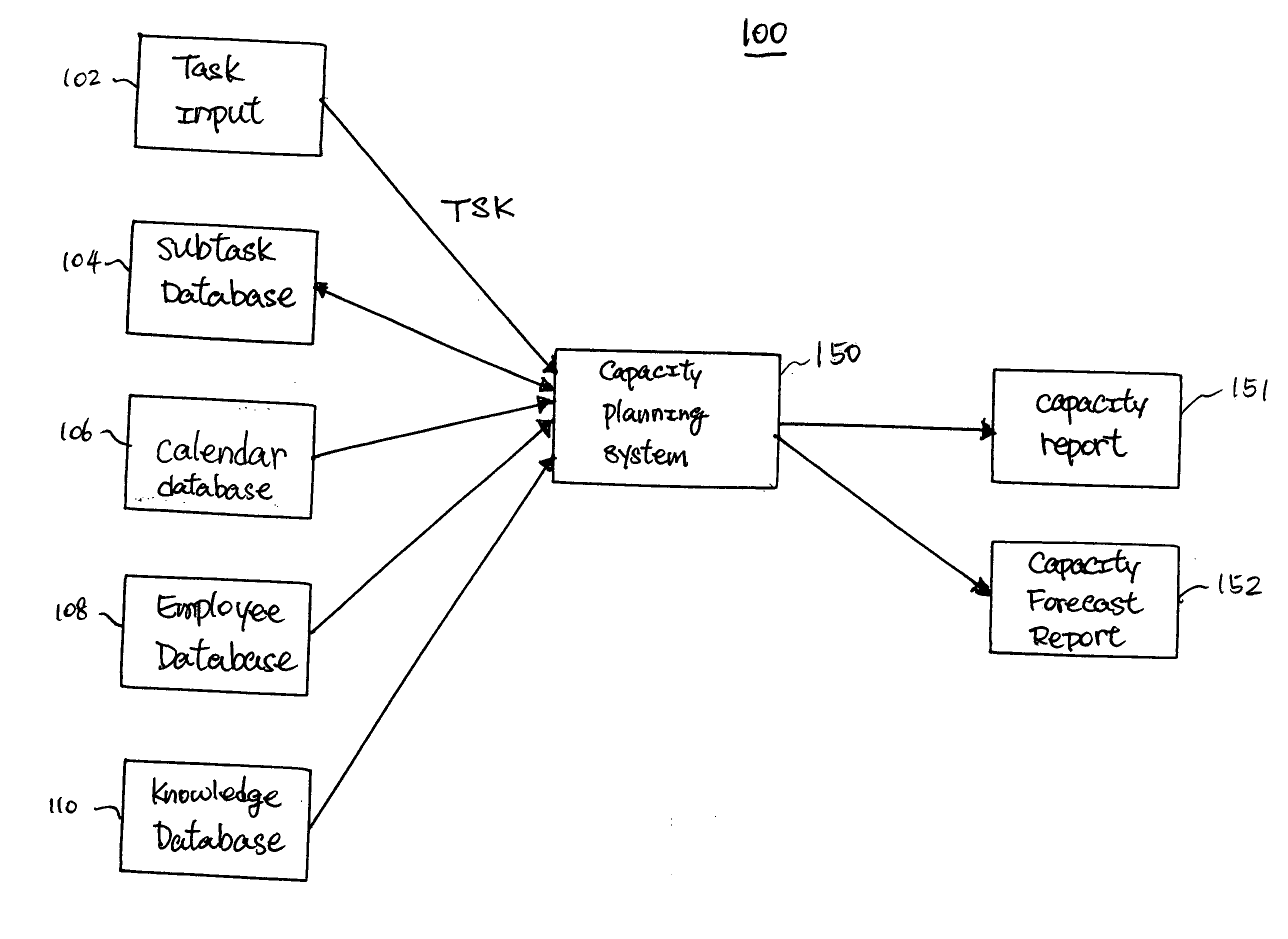

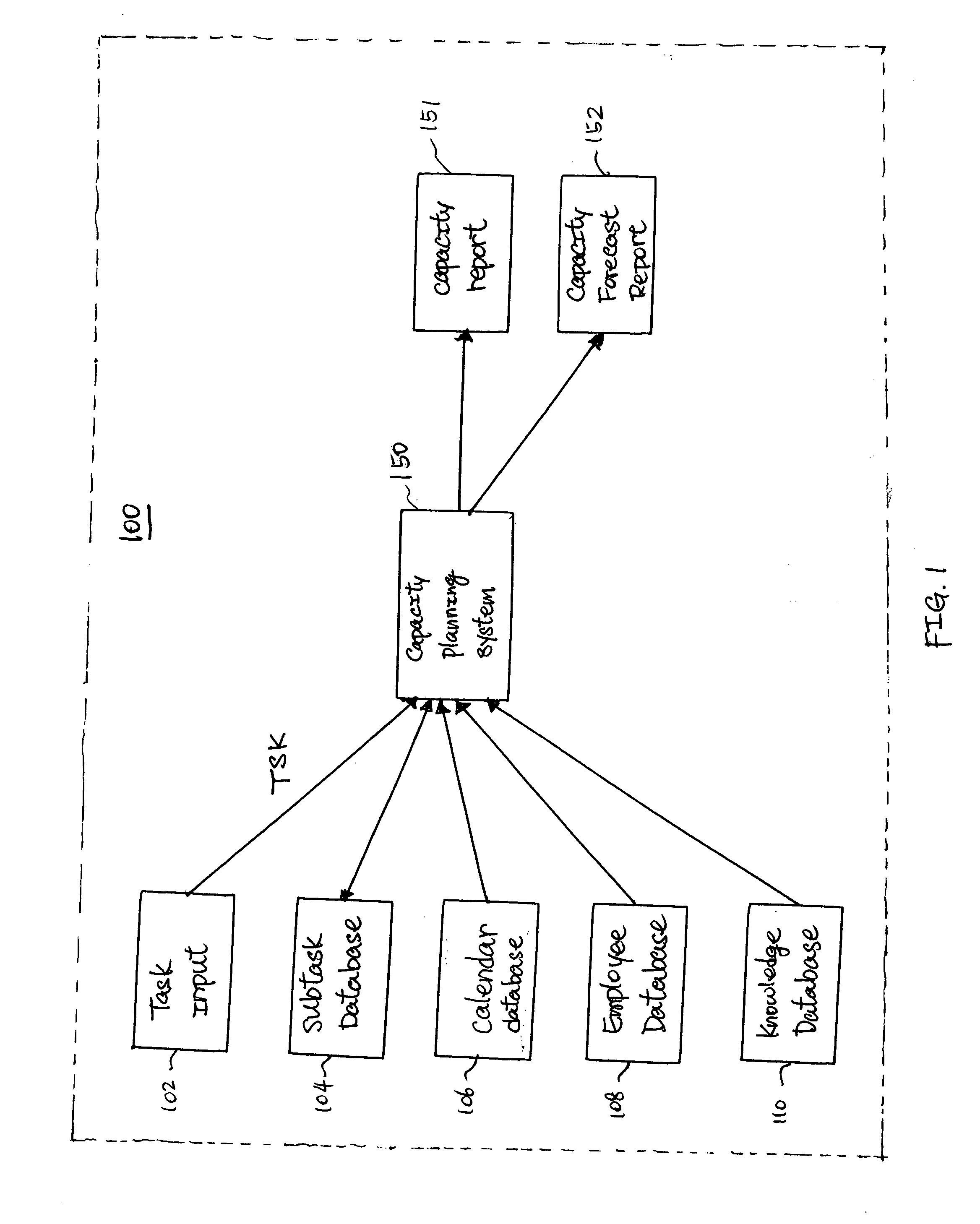

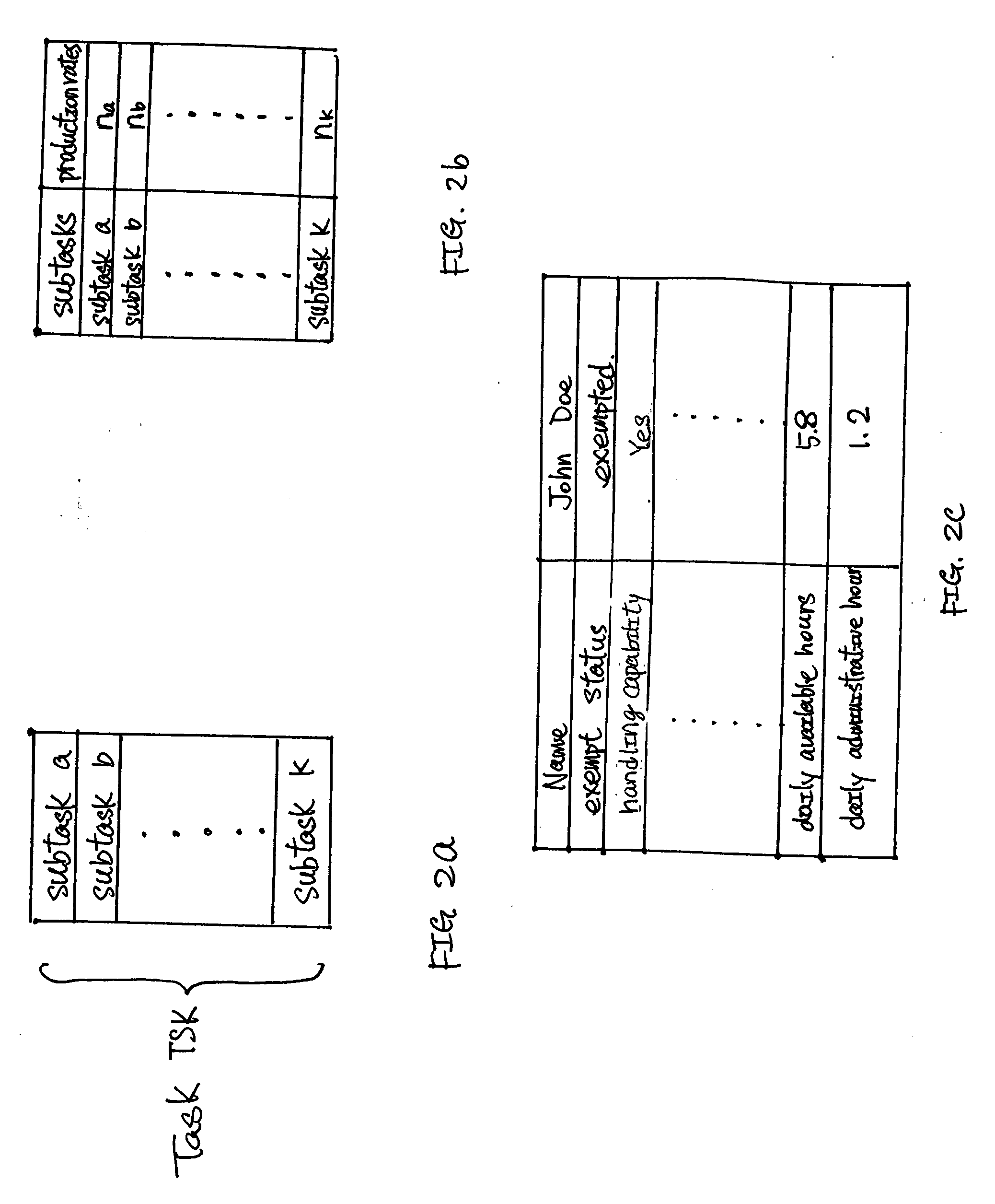

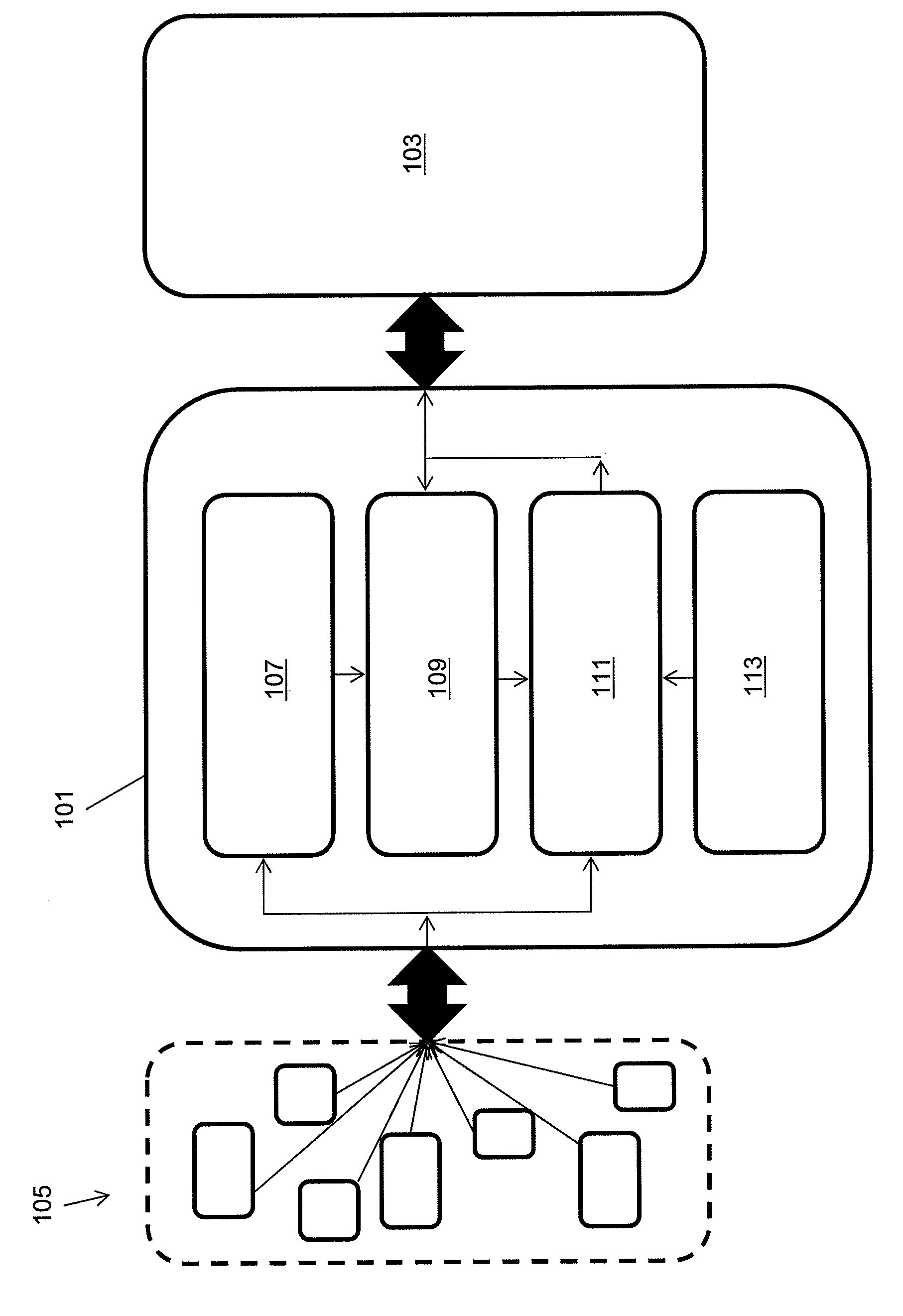

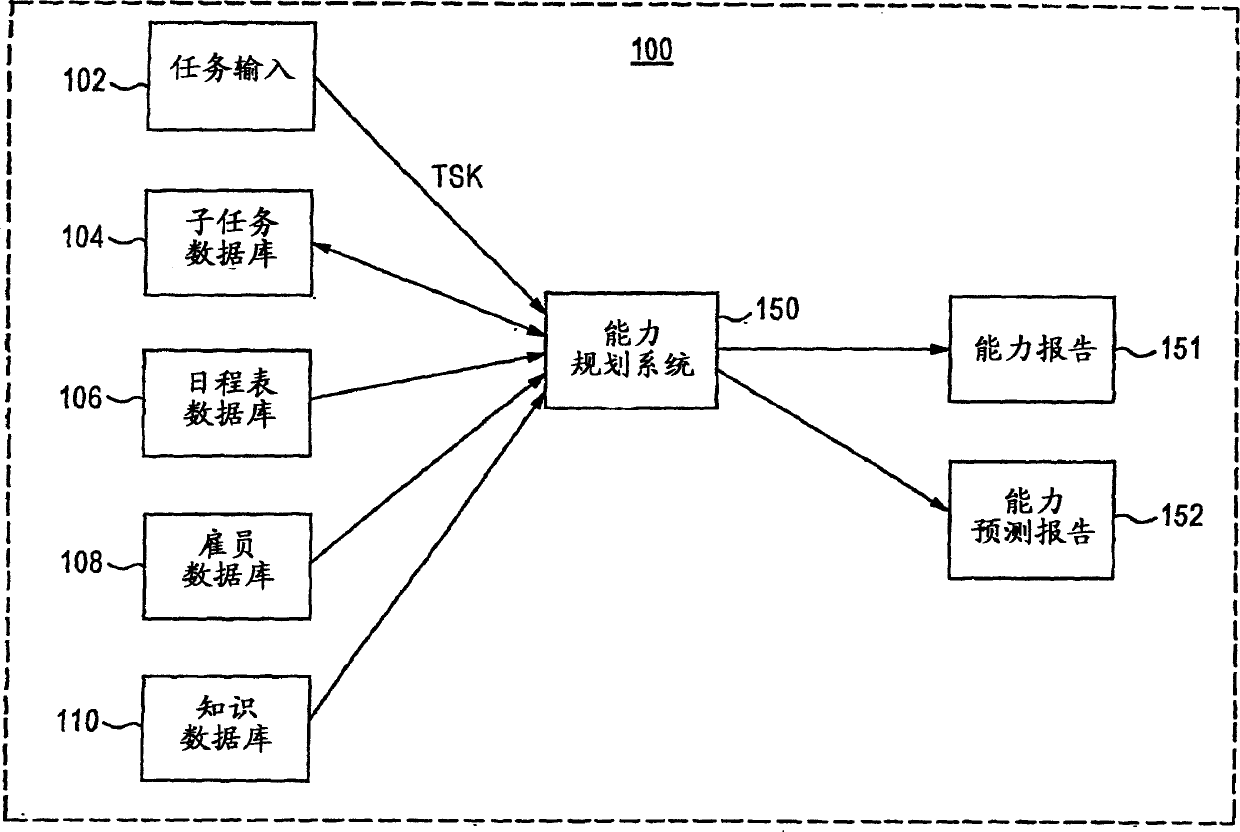

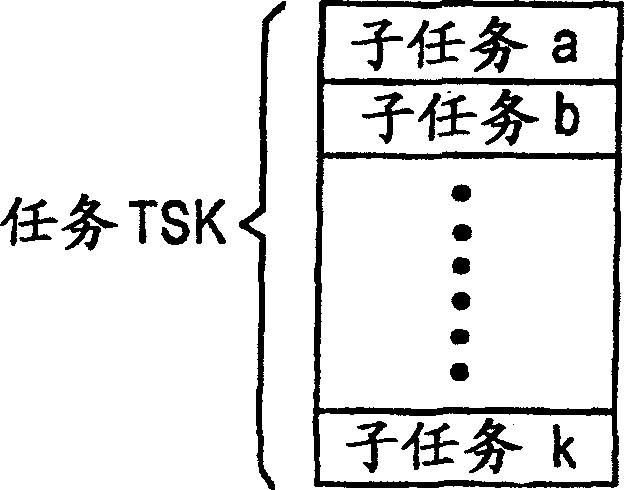

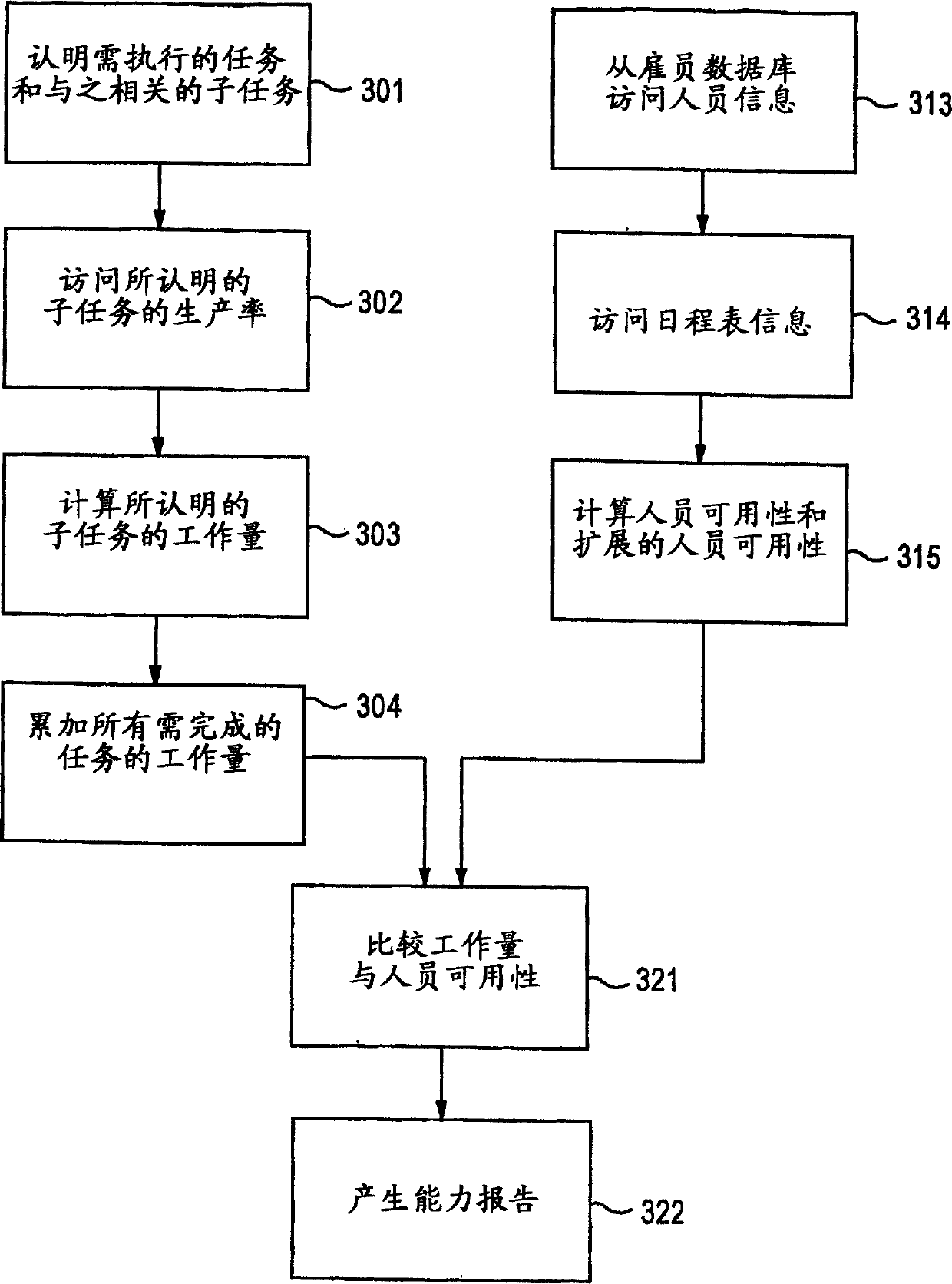

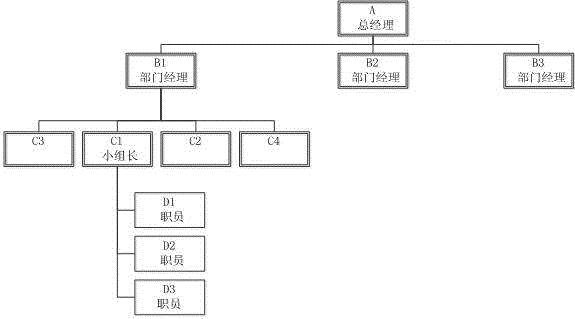

Capacity planning method and system

A capacity planning method and system determines whether an organization has sufficient staff to perform tasks. The method and system identify each of a plurality of tasks to be performed by the organization, and identify subtasks associated with each of the plurality of tasks. Production rate information related to the amount of time or the number of staff needed to perform each of the identified subtasks is then determined. Based on the identified subtasks and the production rate information, a work volume is calculated. Staff availability is determined based on staff information related to the number of employees, identities and positions of employees, exempt status of employees, staff outage, the amount of work time that cannot be used to perform the subtasks, the amount of business days, and / or the amount of defined work hours per day. A capacity report is then generated based on the work volume and the staff availability.

Owner:PERSHING INVESTMENTS

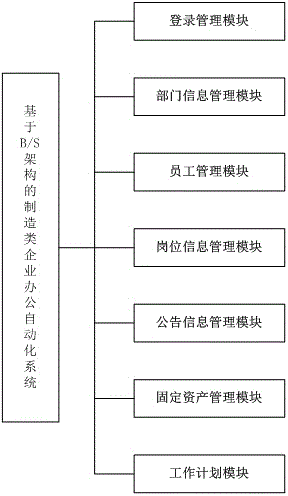

B/S framework based manufacturing enterprise office automation system

InactiveCN105303364AImprove office efficiencyQuality improvementOffice automationInformatizationWork plan

The invention discloses a B / S framework based manufacturing enterprise office automation system. The system is based on a B / S framework and runs on a browser. The system comprises a login management module, a department information management module, a staff management module, a position information management module, a notice information management module, a fixed asset management module, a daily work report module and a work plan module, and is characterized in that the login management module is used for selecting different login identities to log in, the department information management module is used for editing department information, the staff management module is used for checking staff information and carrying out management, the position information management module is used for carrying out position adjustment according to attendance checking information of the staff, the notice information management module is used for publishing information of an enterprise by an administrator and is capable of editing the content and adding an appendix, and fixed asset management module is used for distributing fixed assets to the company staff by the administrator and carrying out management, the daily work report module is used for checking and editing a daily work report, and the work plan module is used for checking and editing a work plan. The system disclosed by the invention is low in cost and convenient to use, can meet requirements of manufacturing enterprises, enables an office environment of the manufacturing enterprises to realize automation and informationization, and improves the office efficiency of the enterprises.

Owner:YANCHENG INST OF TECH

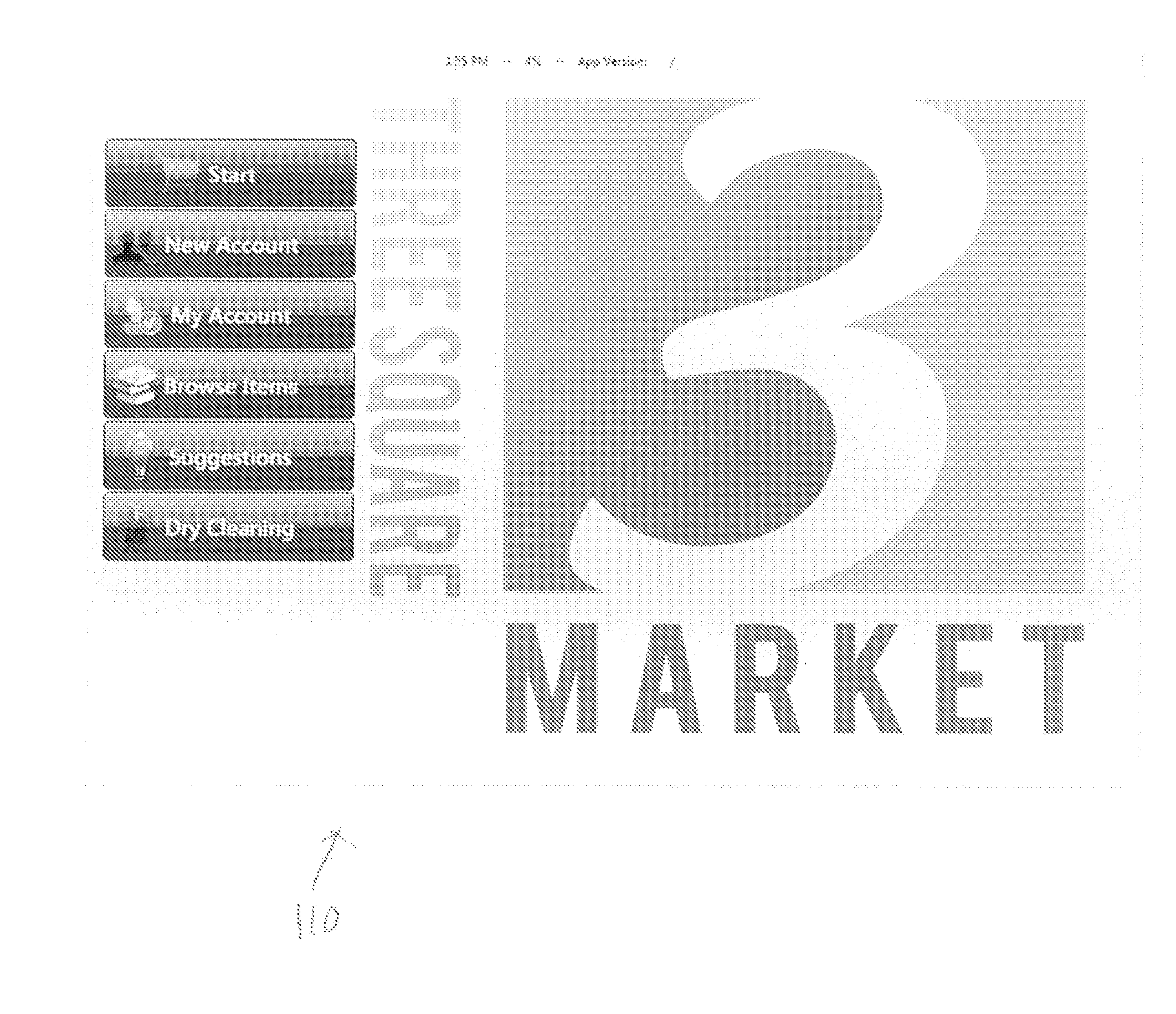

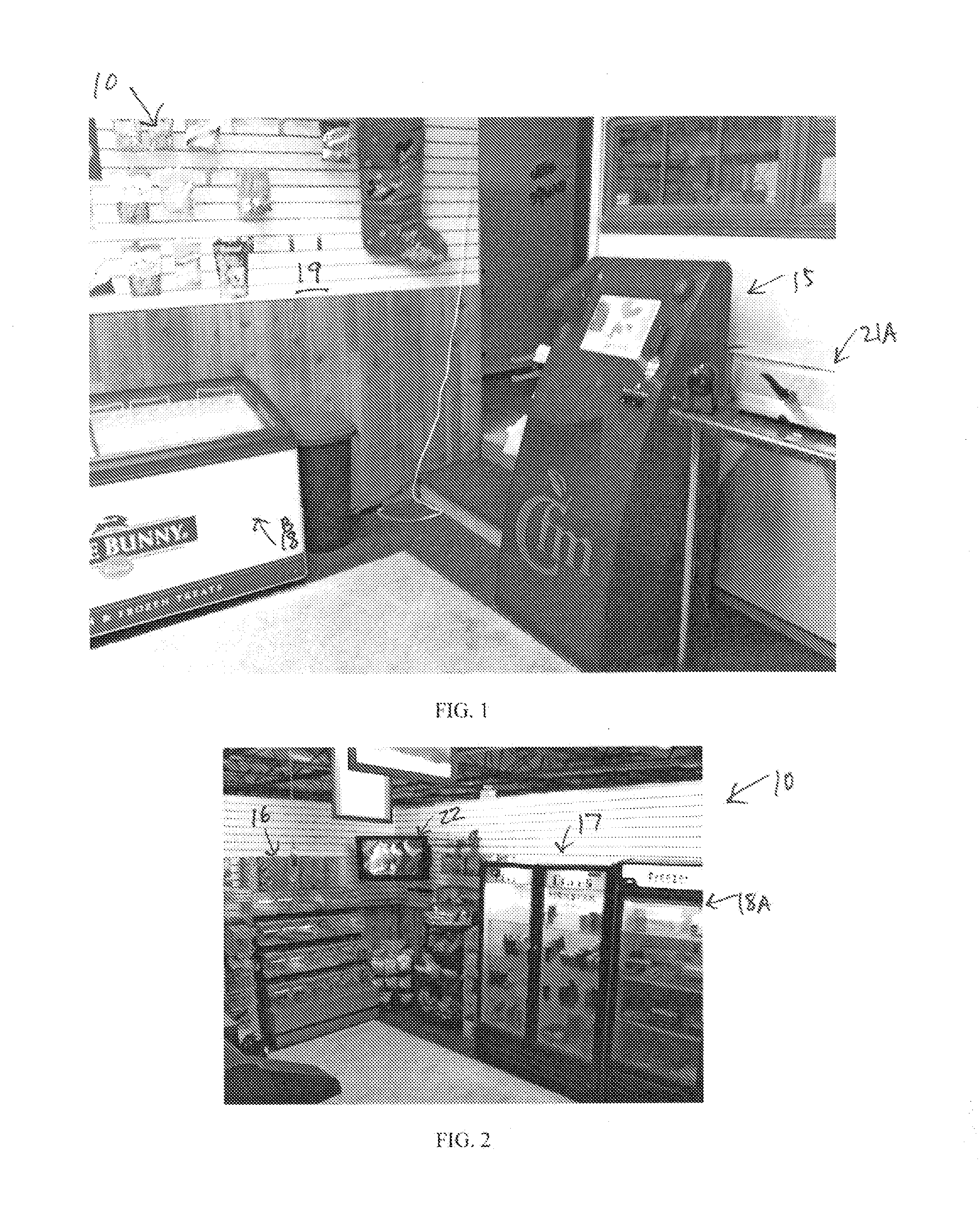

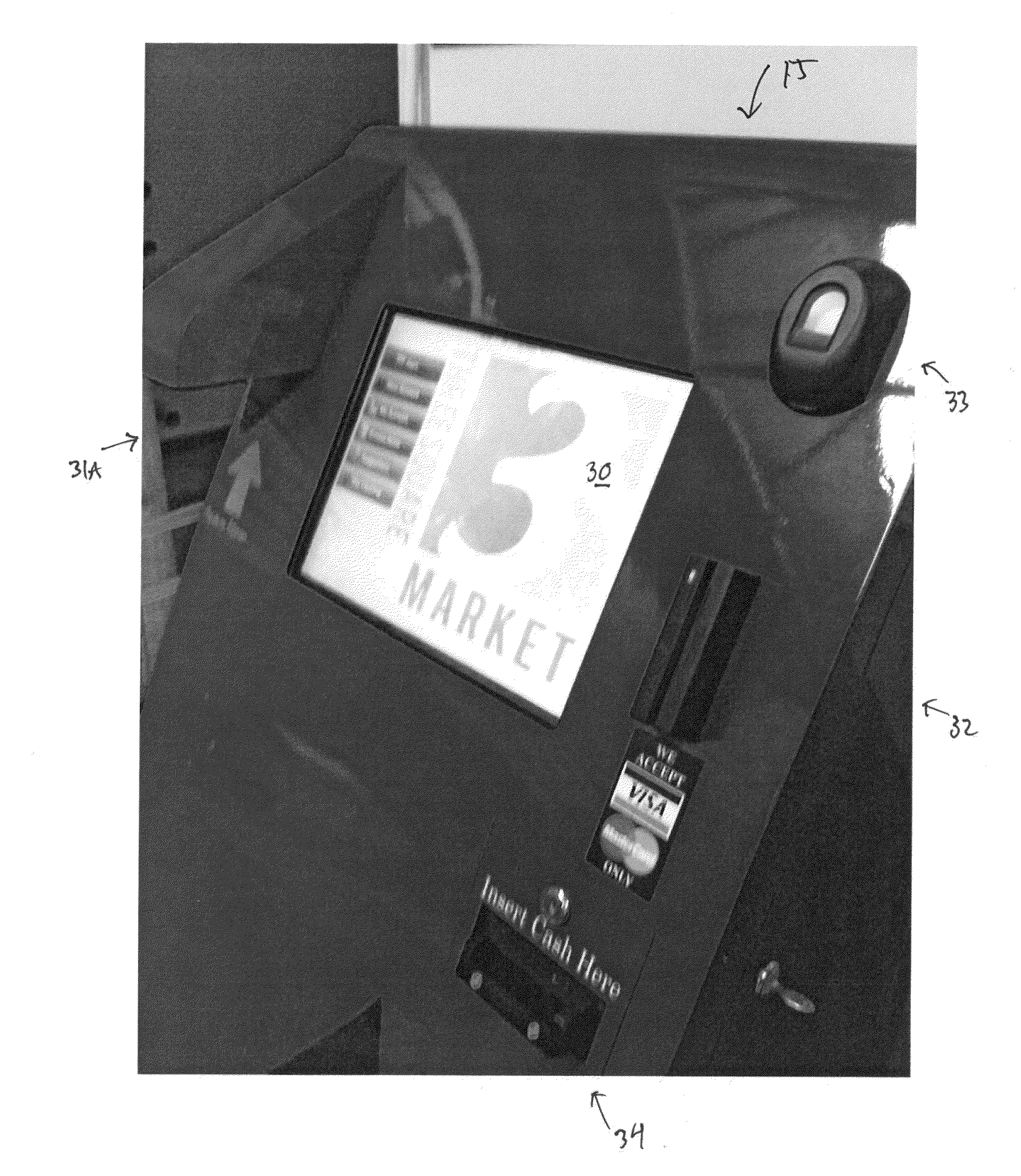

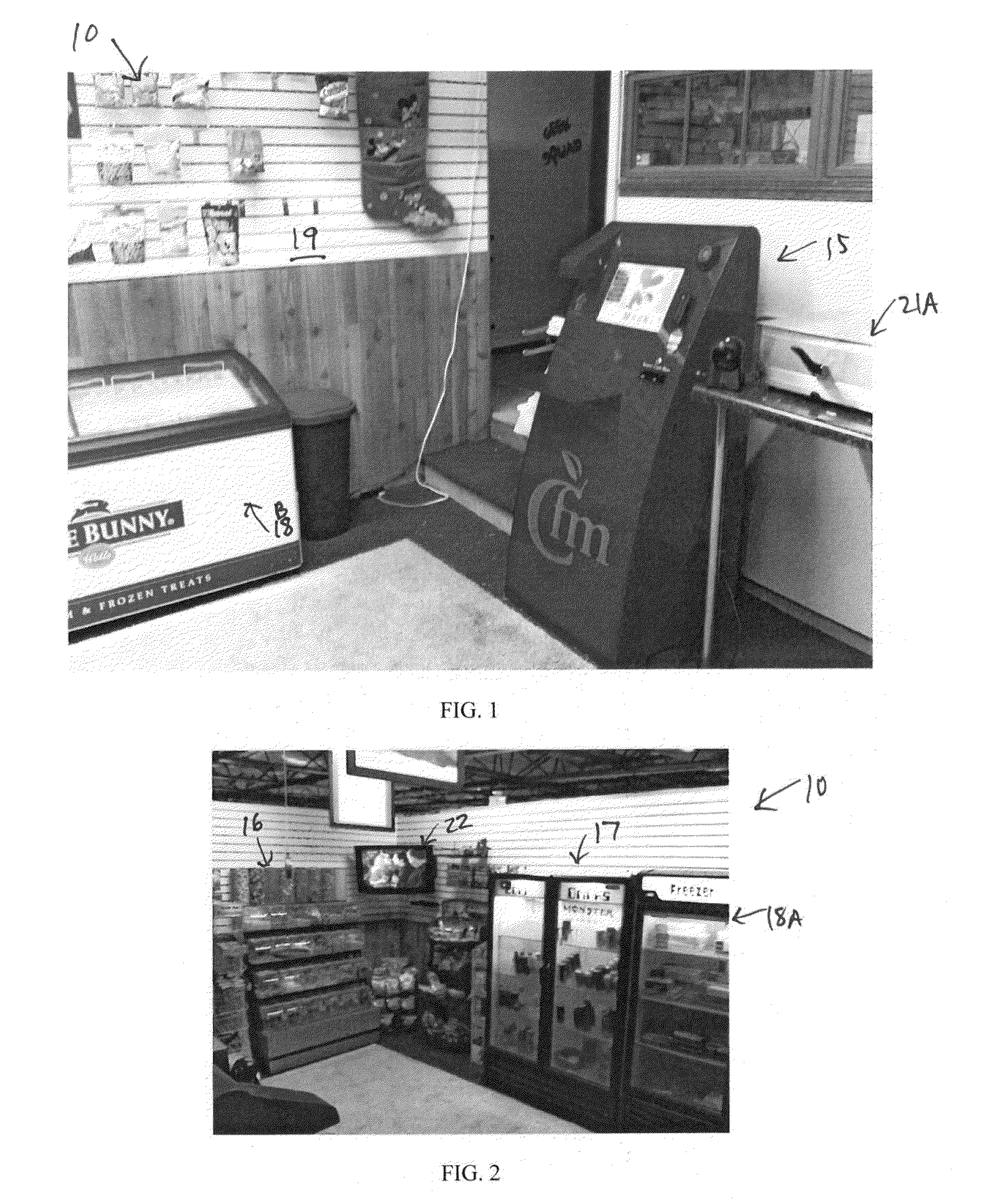

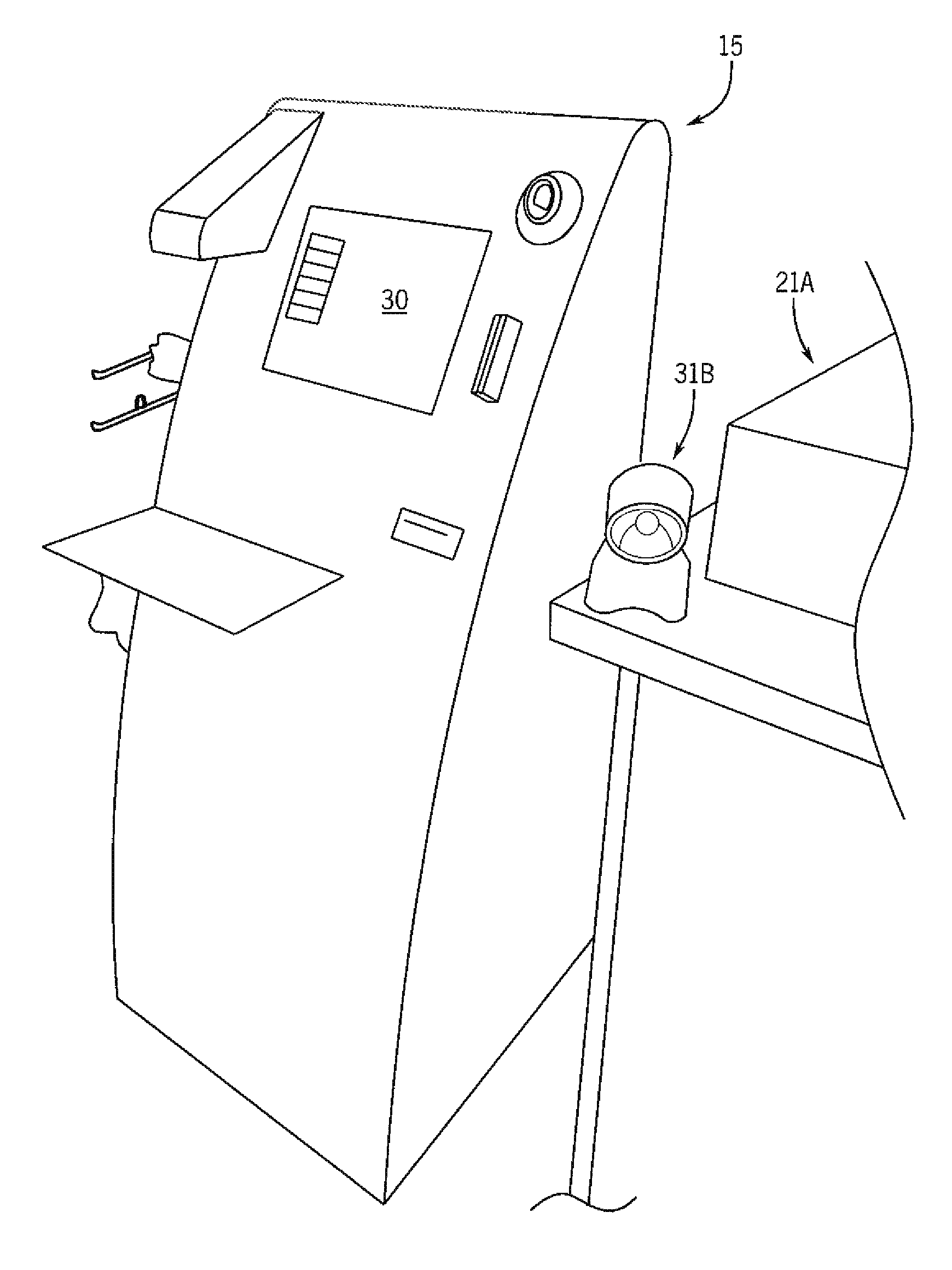

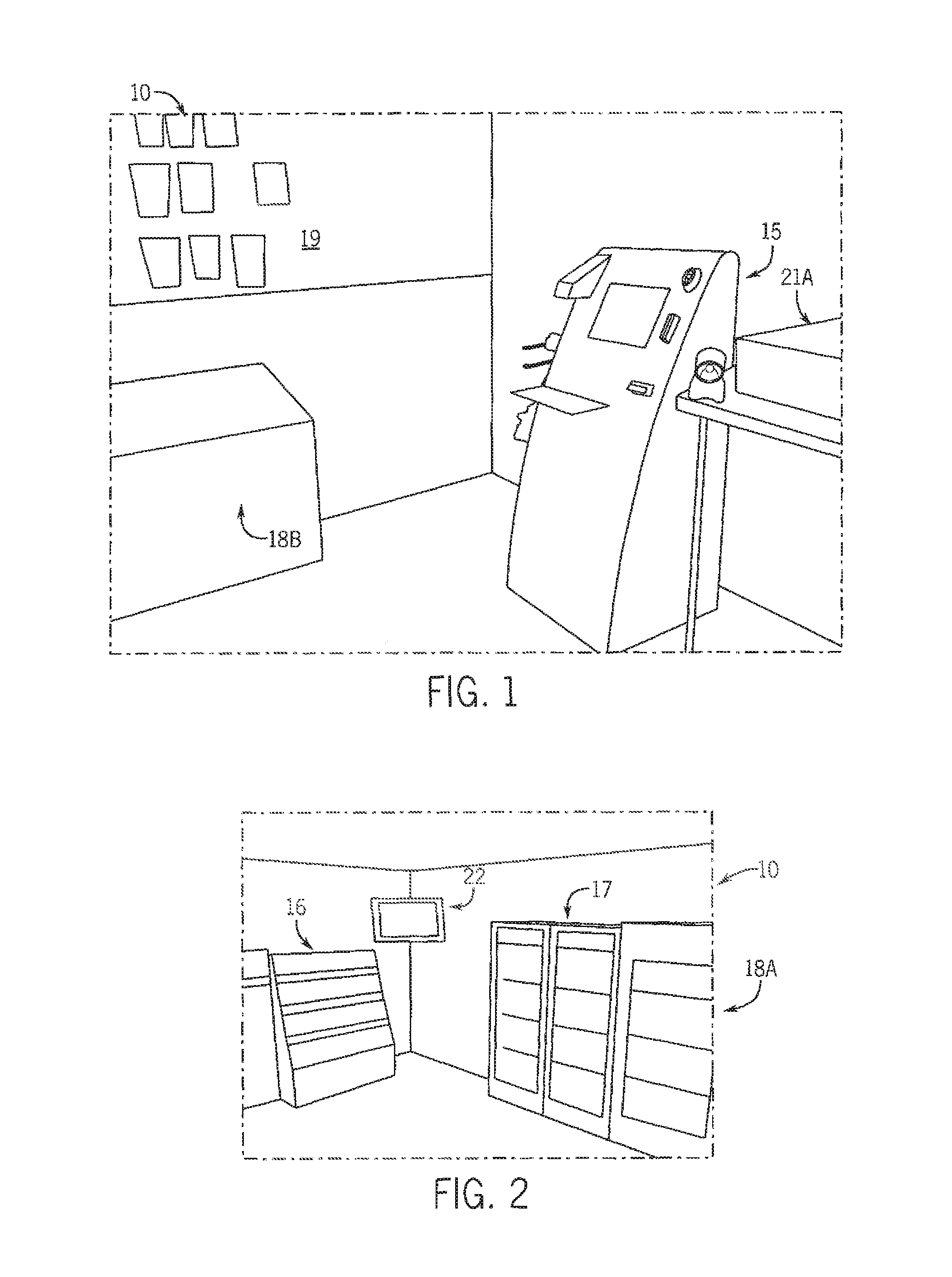

Retail convenience market technology with enhanced vendor administration and user mobile app functionality

ActiveUS20150127478A1Advanced technologyImprove abilitiesCash registersBuying/selling/leasing transactionsMobile appsWorkspace

A self-service, self-checkout micro-market retail shopping system for disposition and use in an private or public office, factory or other workspace for use by employees, workers and the like. The micro-market may supply snacks, candies, beverages, other food items and various convenience items such as toiletries for use by employees, workers and other during the work day, lunch and break time. The micro-market may also supply work related items such as uniforms and apparel, tools, office supplies, travel accessories and the like. The devices and process also include enhanced vendor administration tools and functionality. The devices and process also include enhanced user ability to use mobile devices and apps, and on-line tools for creating and managing accounts and for purchasing items.

Owner:THREE SQUARE MARKET INC

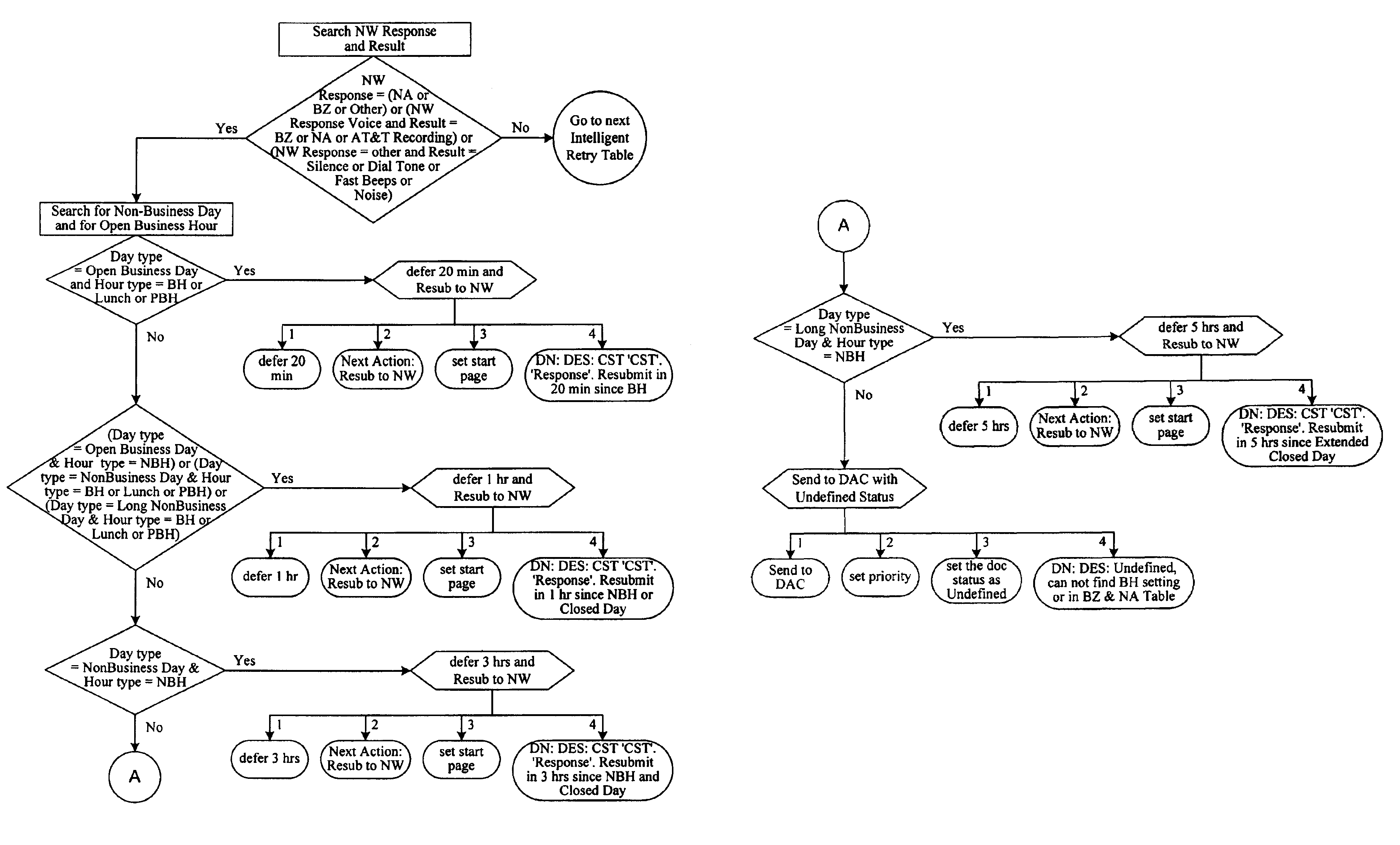

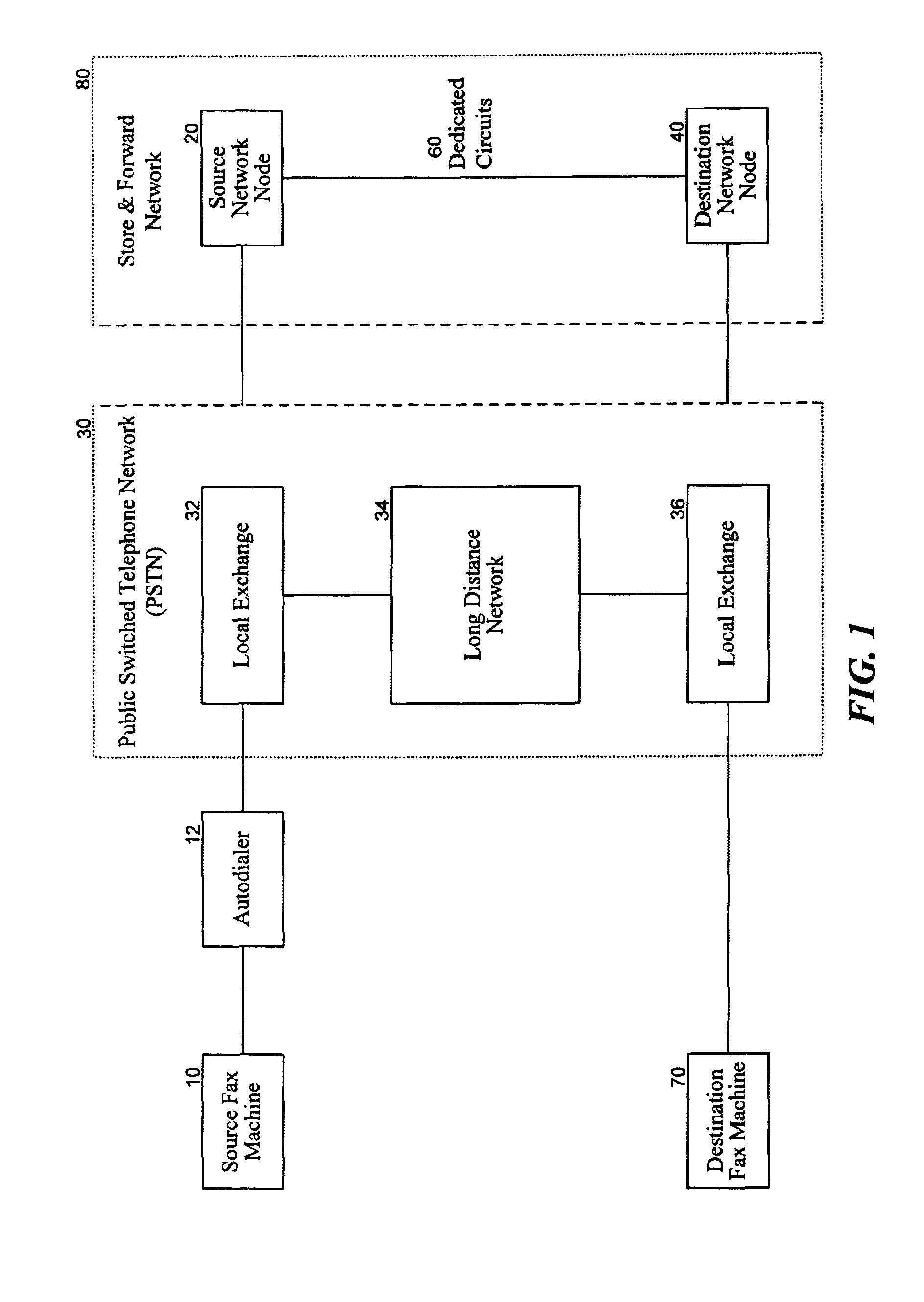

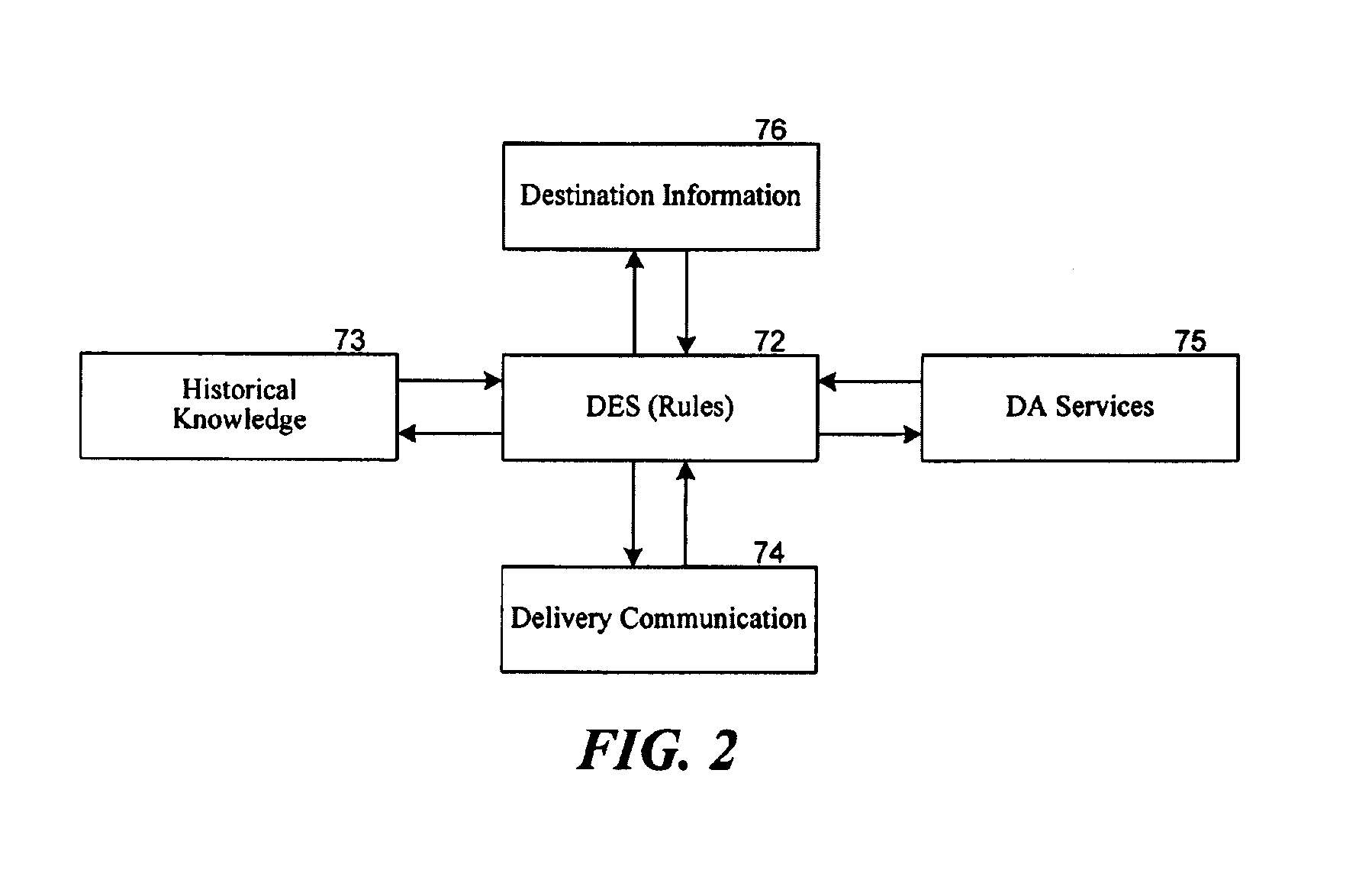

Delivery expert system and method

InactiveUS7265861B1Carried time efficientlyEffective carryVisual presentationPictoral communicationWork periodRule-based system

An automated rule-based system for facilitating delivery of a fax document from a source to a destination over a network where an initial delivery attempt has been unsuccessful. Actions to be taken are based upon a time-variable set of input conditions which may be determined from one or more of the destination, the source, a database of past delivery attempts, and a human analyst. The actions may include one or more of resubmitting the fax document to the network for a next delivery attempt, canceling the document, sending a request to the source or destination for additional delivery information, and identifying the destination as a technical problem. The input conditions may include an identification of non-business days and non-business hours.

Owner:OPEN TEXT SA ULC

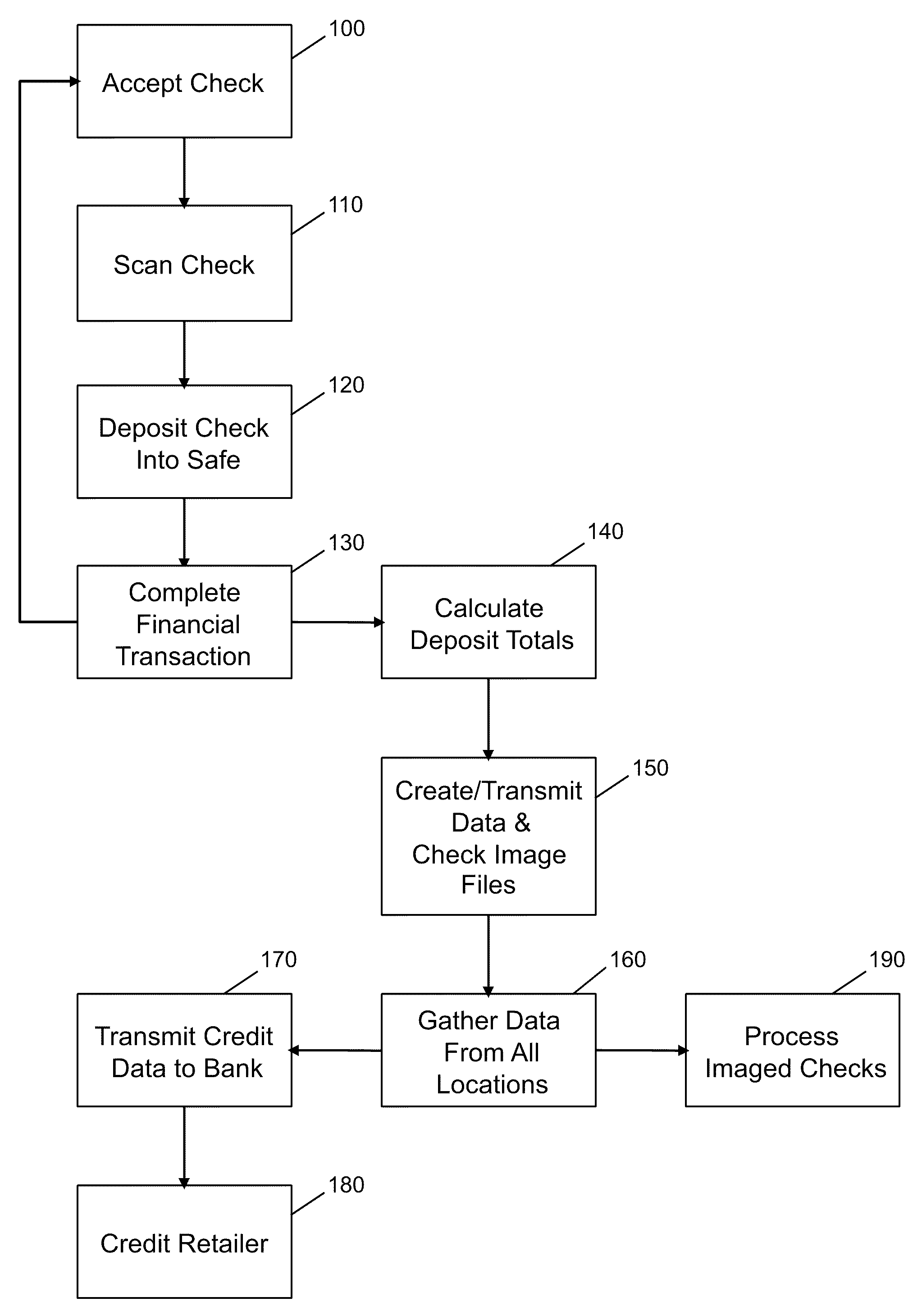

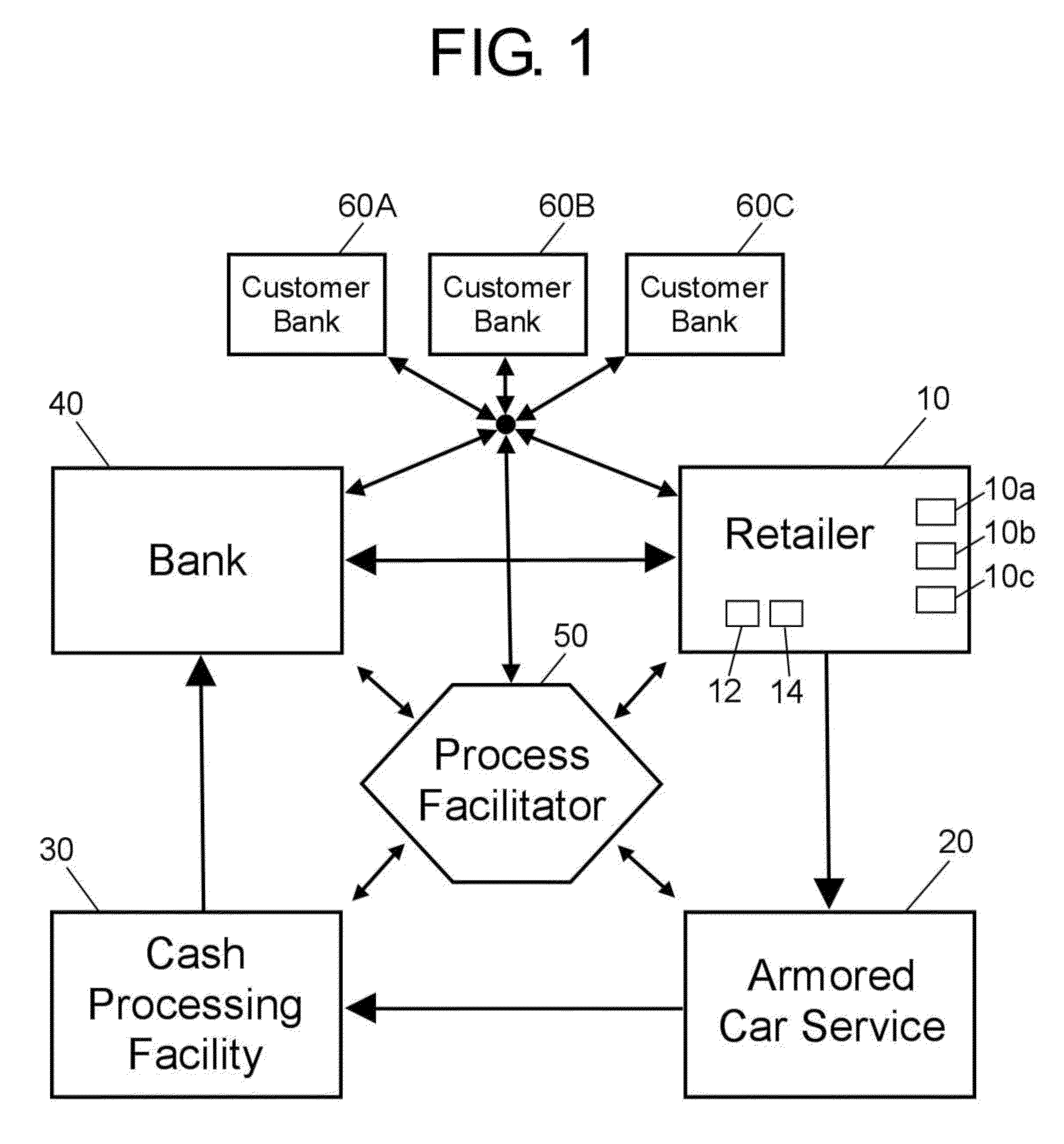

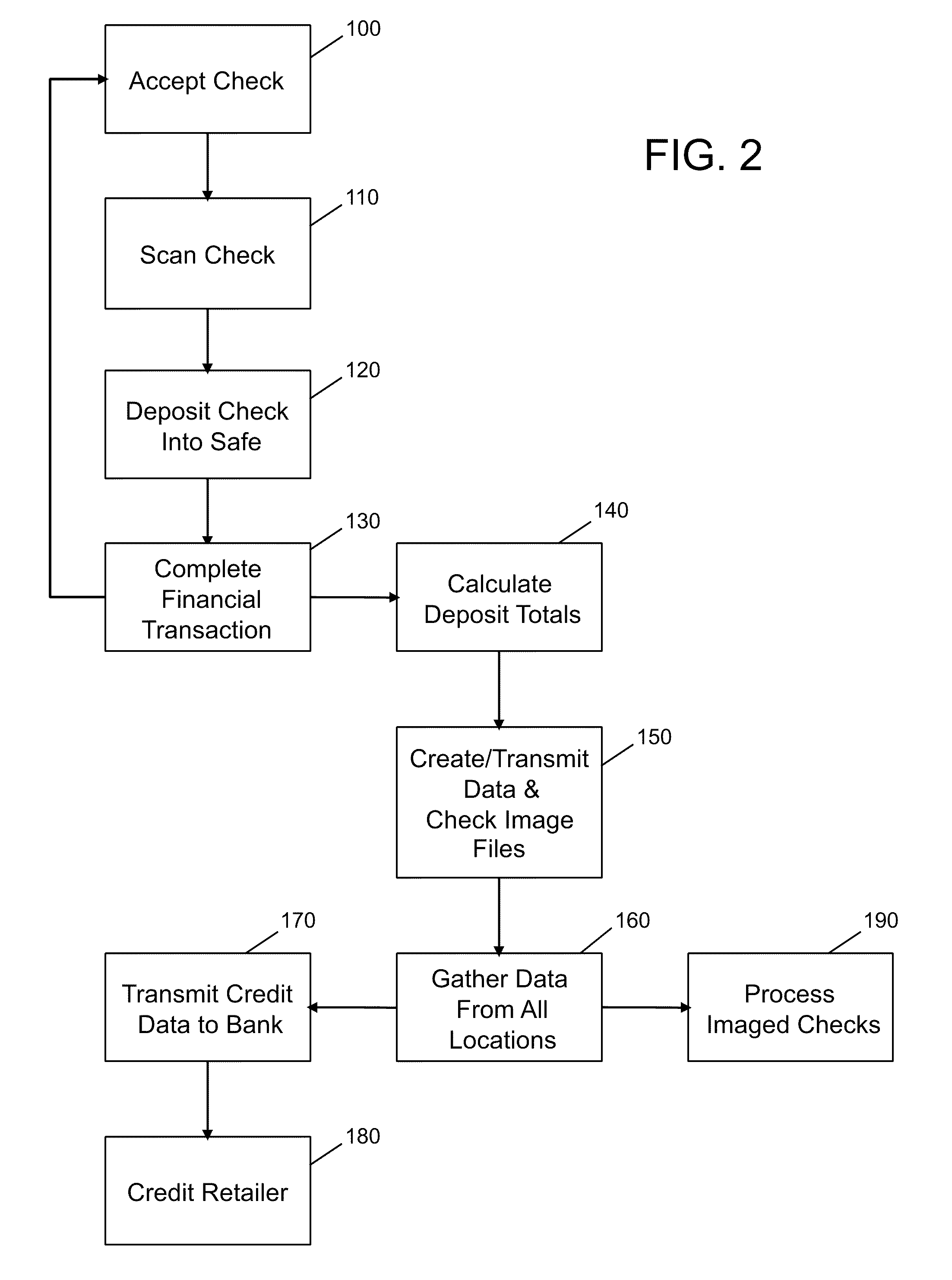

Process of and system for facilitating check processing at point of sale and accelerated credit for check transactions

Process of and system for providing credit to a retailer by collecting checks from customers during financial transactions between the customers and the retailer, depositing by the retailer the collected checks into a safe located at the retailer facility, calculating the total monetary value of the checks that are deposited into the safe, and electronically transmitting a data file that identifies the calculated total monetary value of the deposited checks. Using the information in the transmitted data file, the retailer is credited by a bank or other financial institute with the total monetary value of the deposited checks. Crediting may be provided on a business day basis, and other features include imaging of the deposited checks, facilitating check processing using the image files of the checks, displaying the imaged checks on a display at the retailer during the financial transaction, depositing the checks into the same safe into which cash collected by the retailer is deposited, providing the checks within the safe in sealed cassettes, and printing an image of a collected check on a receipt that is provided to the customer. Other features also are described. The process and system advantageously make funds readily available and improves cash flow to retailers who take-in checks as part of their normal business operations.

Owner:BRINKS NETWORK

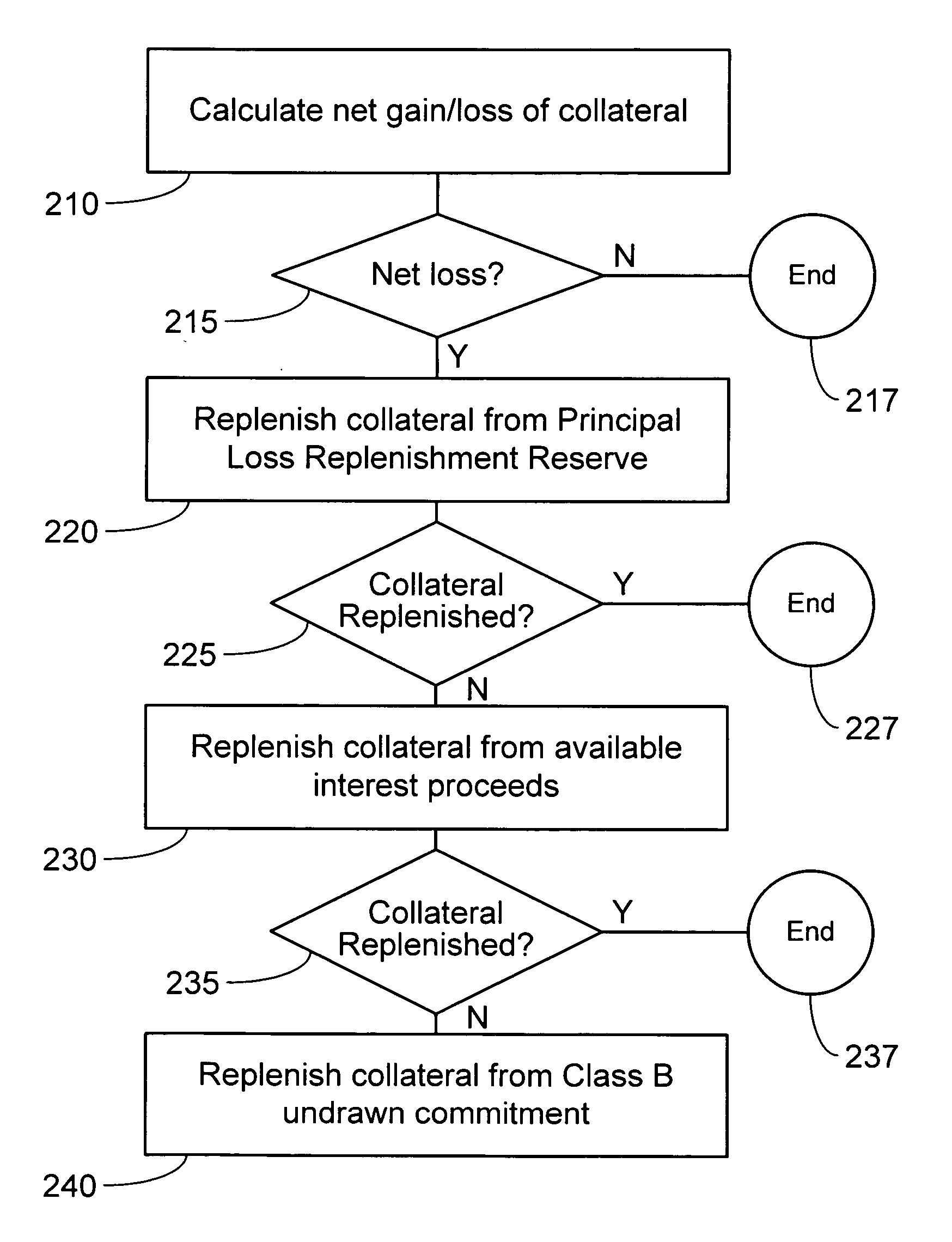

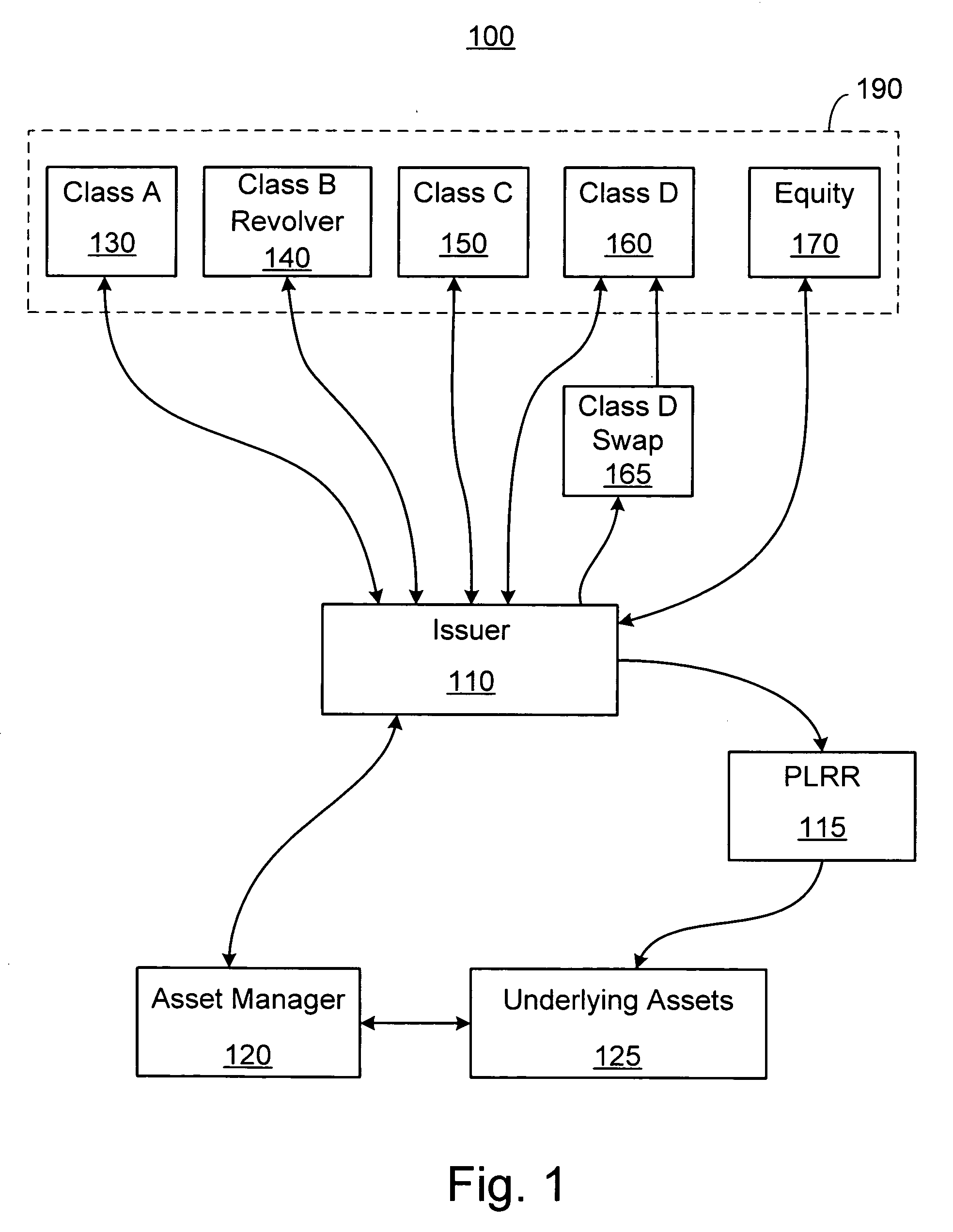

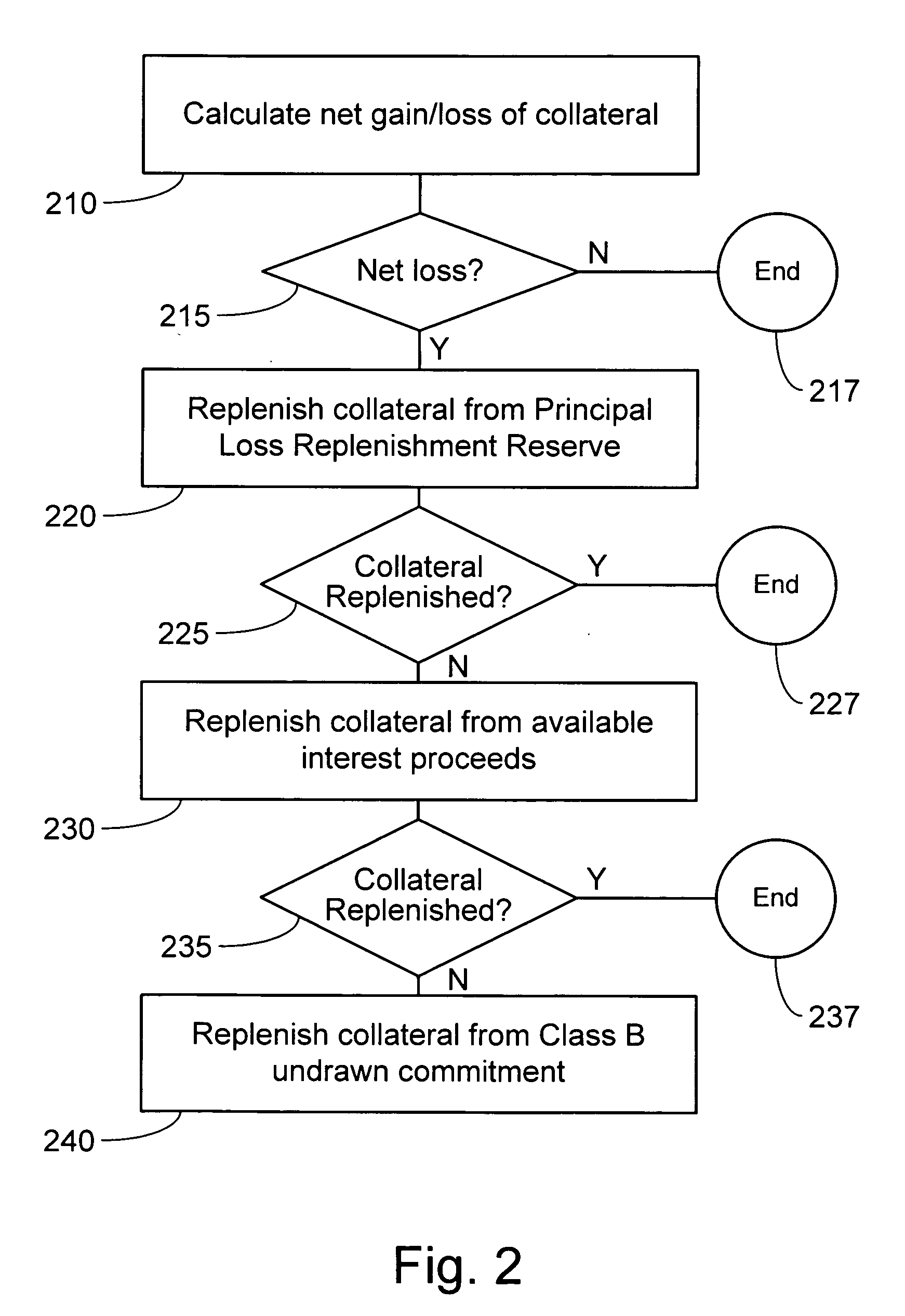

System and method for collateralized debt obligations

A collateralized debt obligation is described having a subordinated revolver note. The revolver noteholder is committed providing funds to purchase additional assets to maintain the original principal value of the collateral. The amount of additional assets is determined at the end of each due period on the determination date. Funds to purchase the additional assets are received from the revolver noteholder, if required, on the payment date. The payment date follows the determination date by a predetermined period, preferably by five business days. The delay between the determination date and the payment date reduces the liquidity requirement of the revolver noteholder thereby increasing the marketability of the revolver note.

Owner:BARCLAYS CAPITAL INC

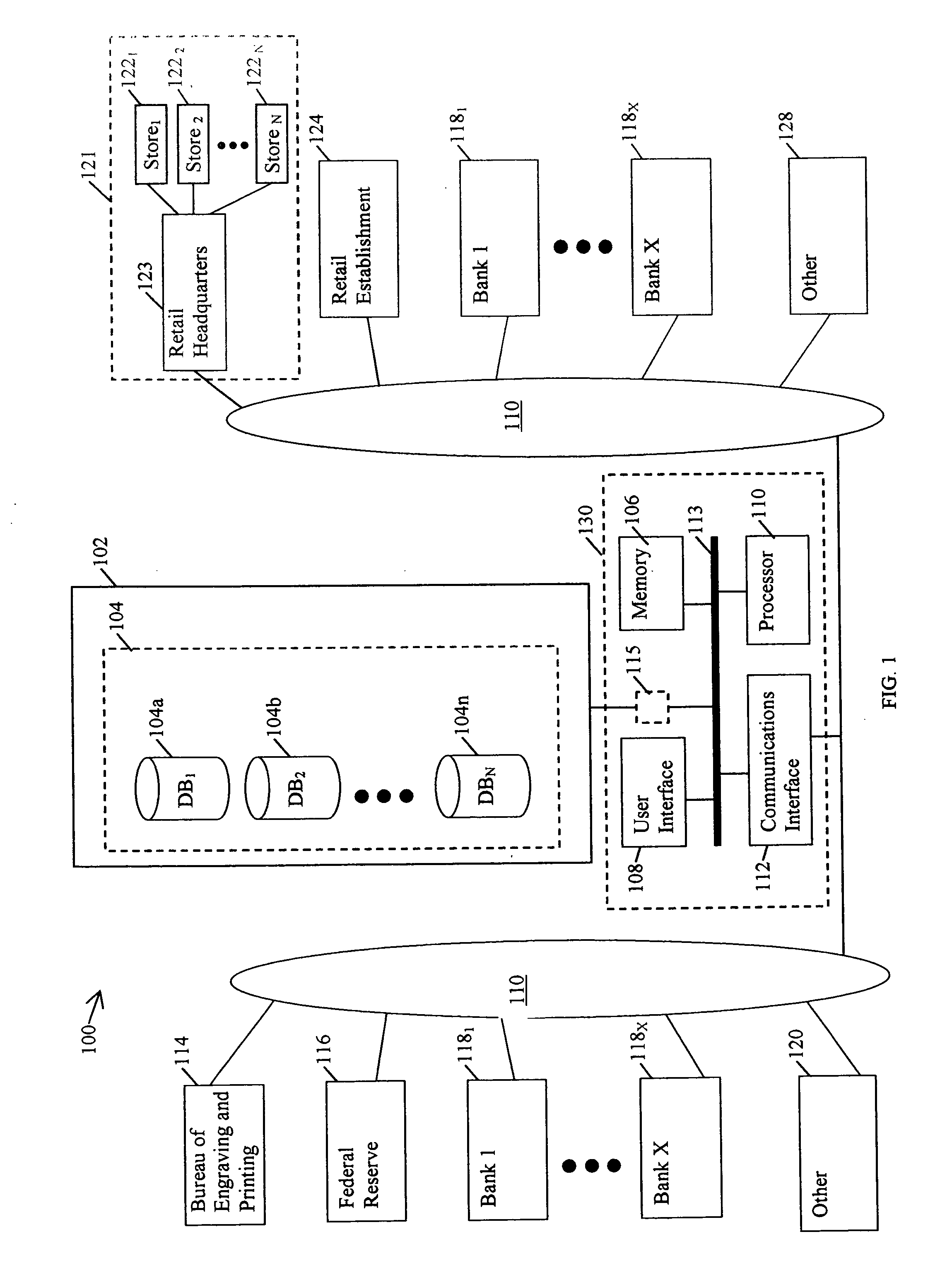

System for accessing account sufficiency information to enhance the success rate for clearing checks

InactiveUS20050080729A1Increased cost-effectivenessCostFinancePayment circuitsService provisionCheque

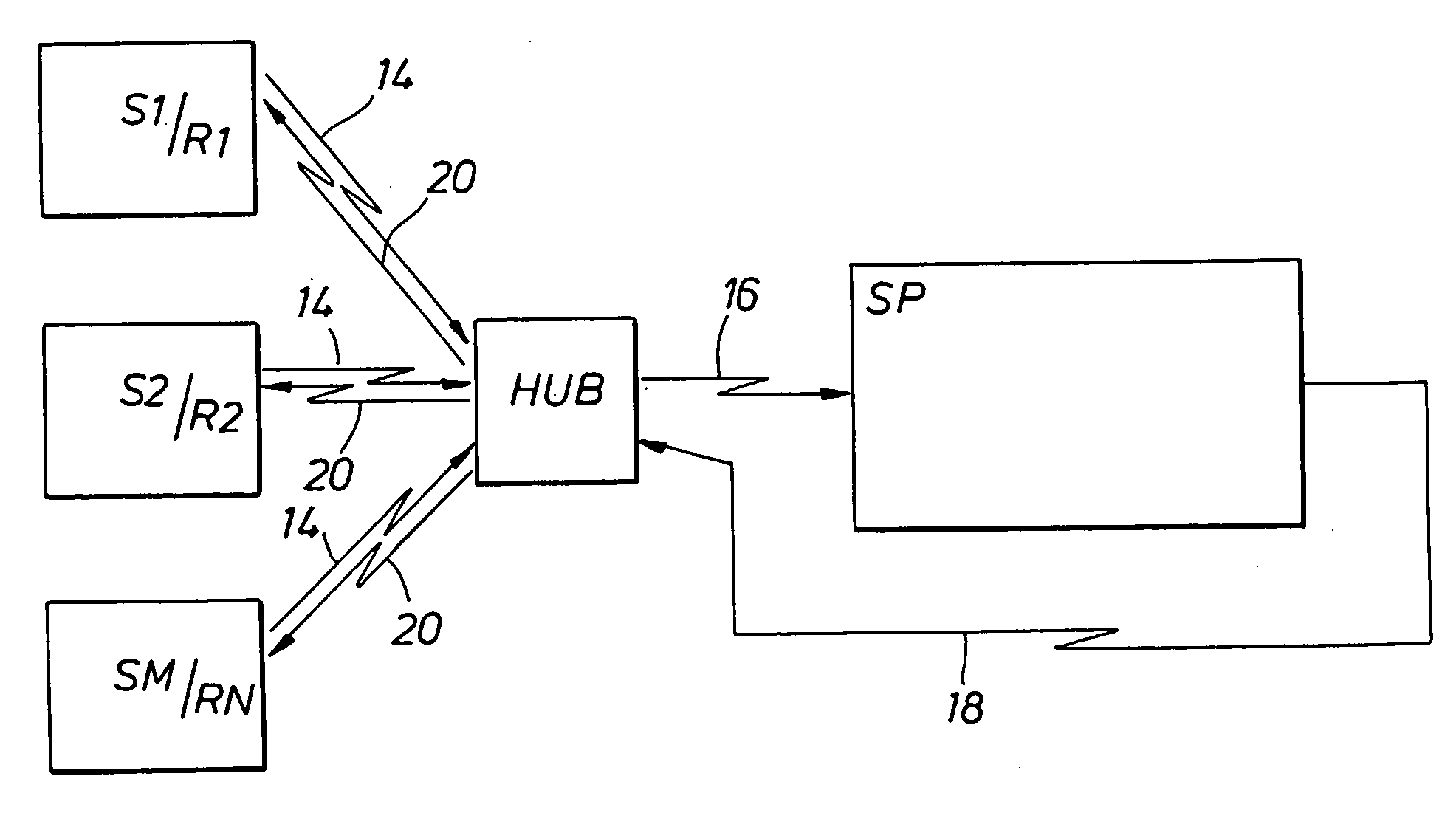

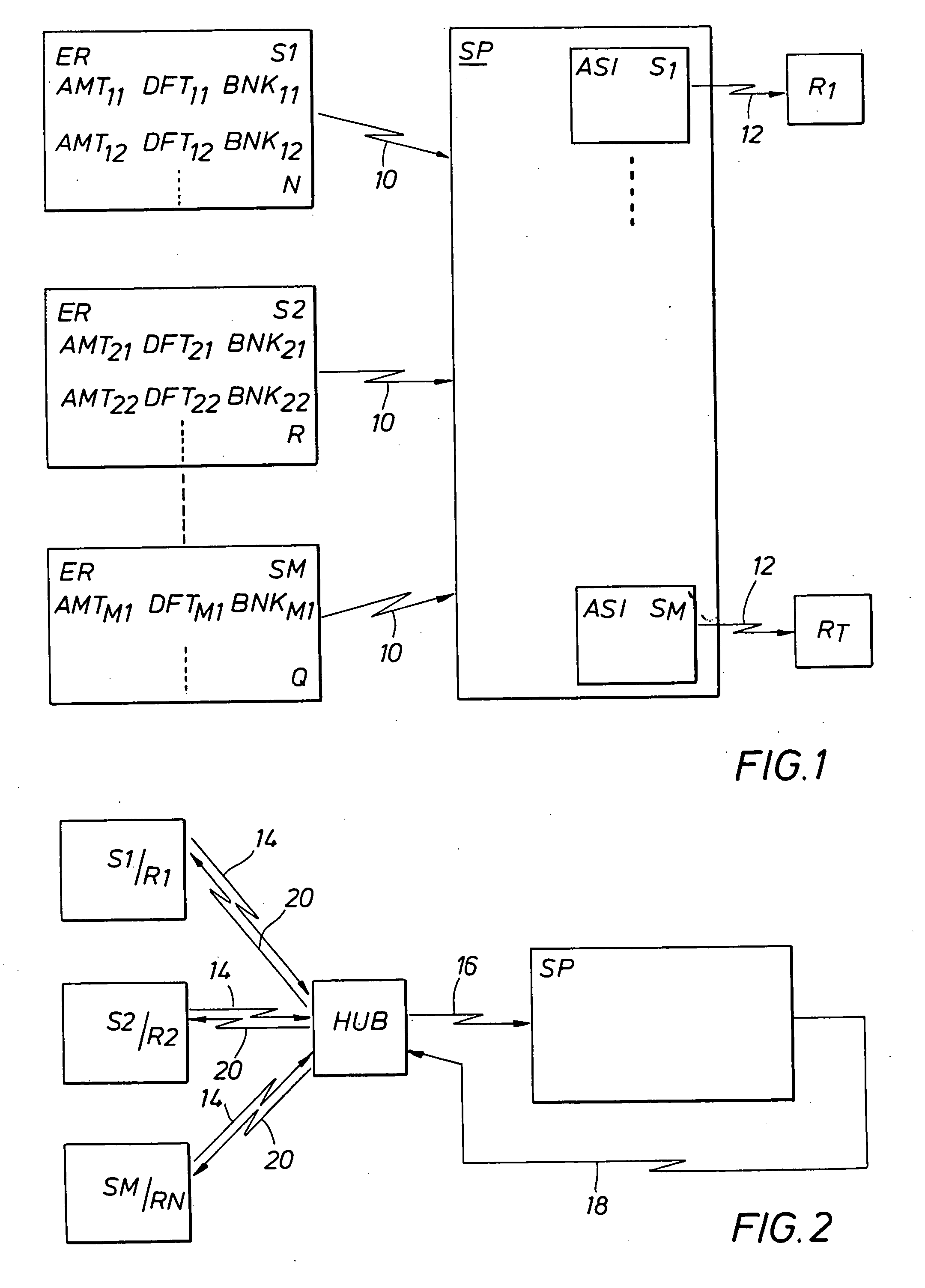

An improved system for accessing account sufficiency information relating to checks, in order to enhance the success rate for clearing bank checks, including receiving at a service provider electronic records from a plurality of sources and ascertaining by the service provider account sufficiency information from the participating banks in regard to at least 1000 checks per business day, on average, relating to said records. The system may include economies of scale such as at least partial automation of callers, opening service provider accounts at banks and / or batching checks for callers from different sources or holders.

Owner:AUTOMATED FUNDS VERIFICATION

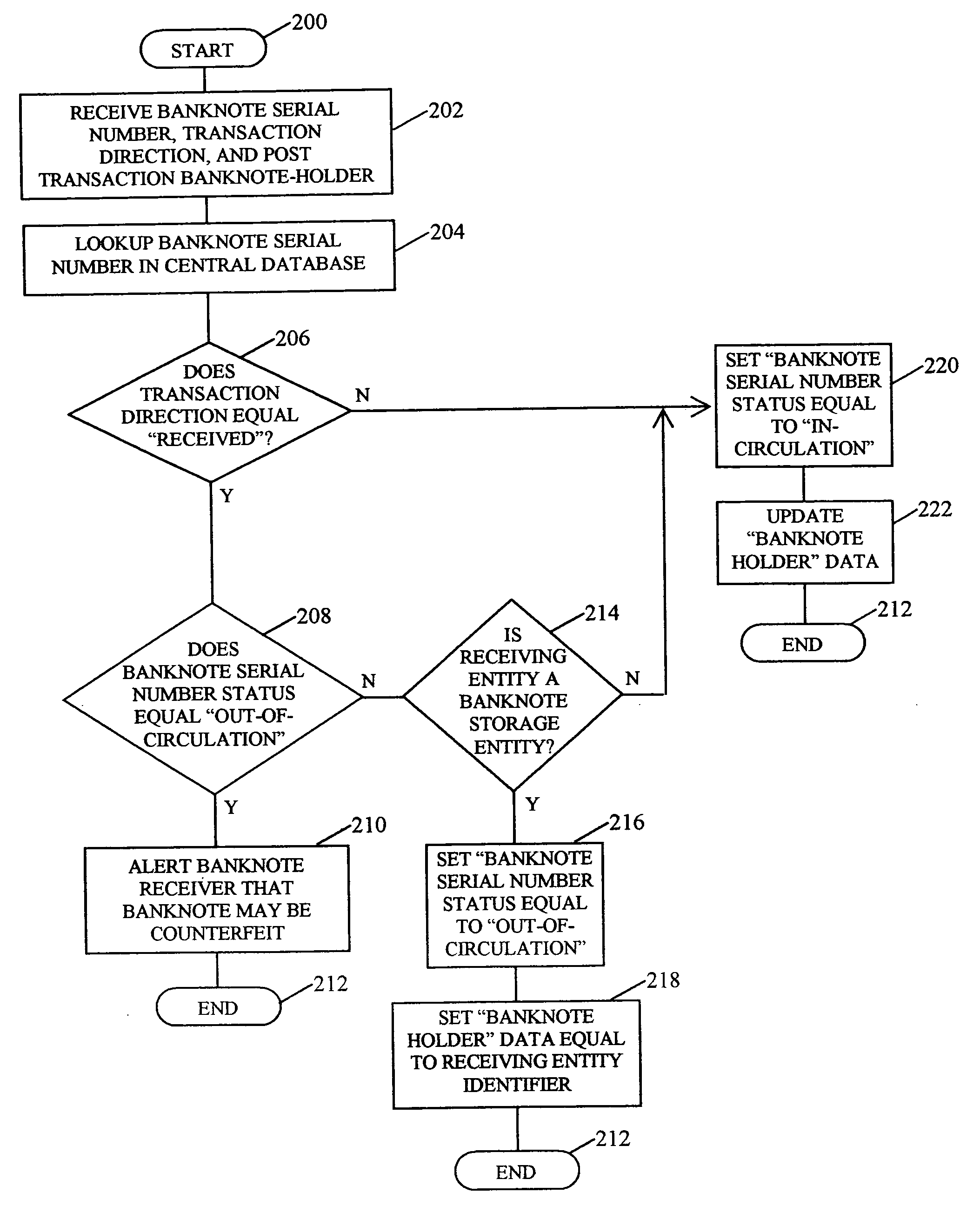

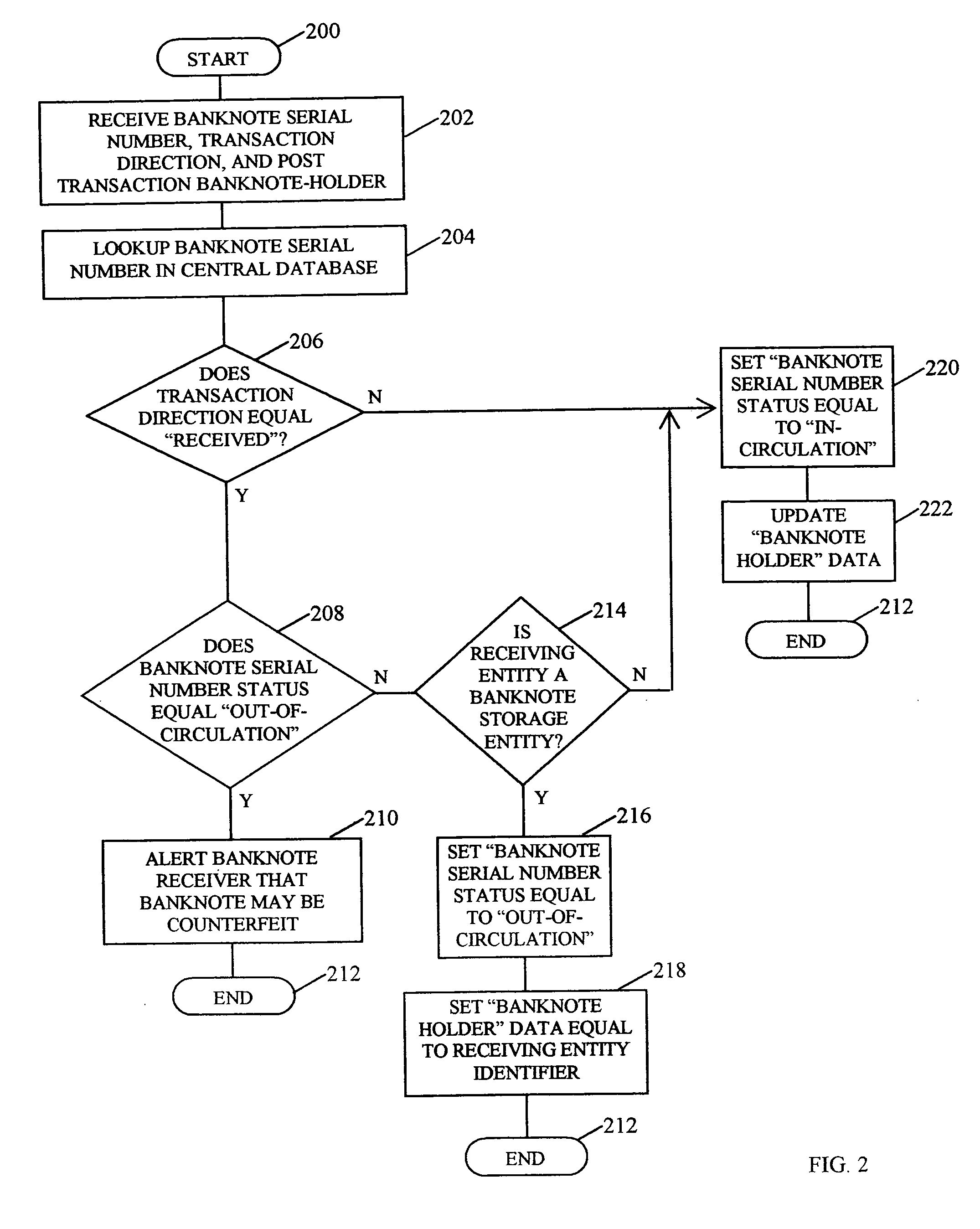

Banking transaction tracking

The idea behind this patent filing is to have the ability to track currency. The idea has a use at both the local economy as well as at the federal government level. At the local level, an example of the idea would be a chain store, such as a WAWA or 7-11 chain.The chain head quarters in most cases are located in a city other than the store location. All daily reports are transmitted to the corp. office at the time of closing or during the next business day.With this idea, a corp. can pull reports in REAL TIME, know the amount of cash taken in during any given time of the day, and know exactly what amount of currency should be deposited into the bank account.Another benefit to the home office is the info about the time of day and days of the week the store is doing the most business and will have the info needed to staff that location to support the flow of customers.At the federal level, governments will have the ability to see where the currency is being deposited, spent, on what products currency is being spent on.Huge cooperation doing business in the US, makes deposits in tax exempt countries, making that money tax free.Another reason to track currency is the info the government would have as to money laundering, drug money and money used to support terrorism.Where is the currency being deposited, by who and who is with drawling that currency? This idea could be used in the war against terrorism, the drug war, tax evasion and a tool to help governments to predict the economic future.

Owner:FAULKNER JAMES OTIS

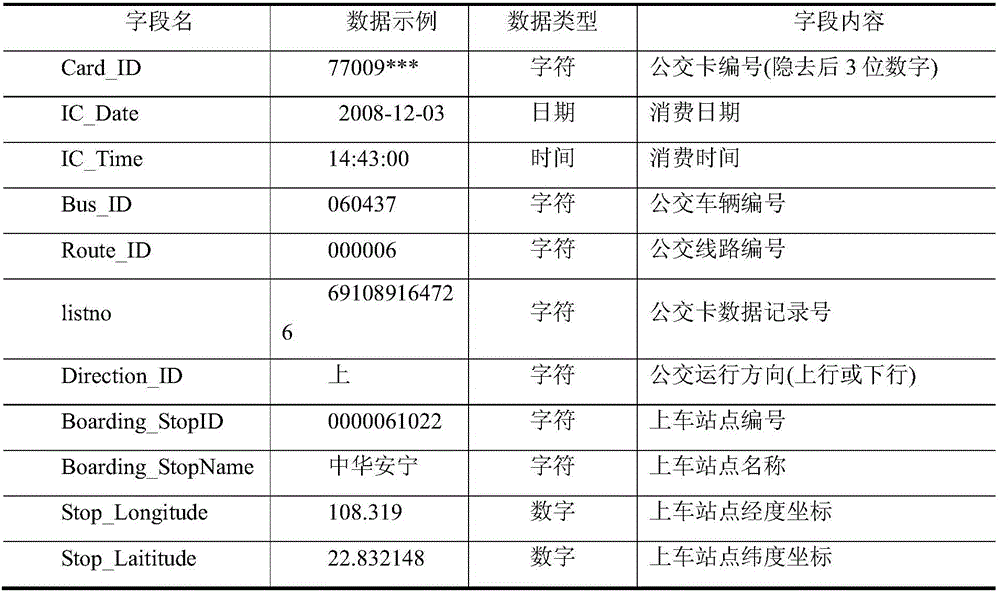

Method for judging getting-off stations of public transportation IC card passengers based on historical trip patterns

The invention provides a method for judging the getting-off stations of public transportation IC card passengers based on historical trip patterns. Intelligent public transportation system data are acquired; public transportation IC card data are associated with intelligent dispatching system data, so that the getting-on station information of the public transportation passengers is obtained; commuting passengers in the public transportation IC card passengers, as well as the residence places and working sites of the commuting passengers are identified through a commuting OD estimation method; getting-off stations of the commuting trips of the current day are judged through using obtained commuting trip patterns; the getting-off station information of a part of the trips of the public transportation IC card passengers in the previous days is obtained through using a trip chain method; and the trips of the current day are matched with the associated trips of the previous days, so that the getting-off stations of the trips of the current day can be judged. The method provided by the invention is implemented through algorithms; and testing and accuracy analysis are performed on the algorithms through using a large number of practical data. The proportion of judged getting-off stations of the passengers in workdays is increased by 12.13% on the basis of an existing method, and an accuracy rate reaches 87.89%.

Owner:XI'AN UNIVERSITY OF ARCHITECTURE AND TECHNOLOGY

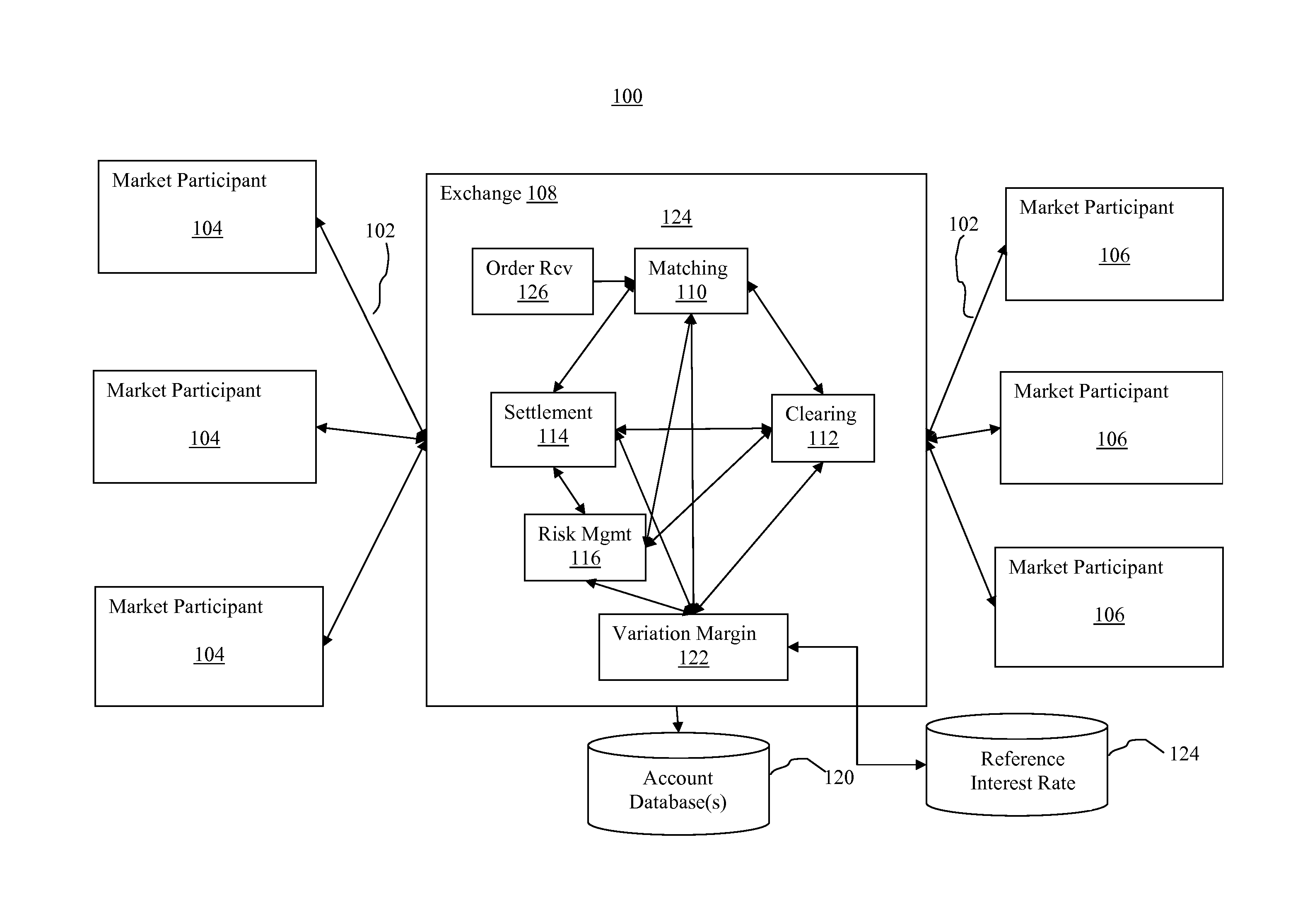

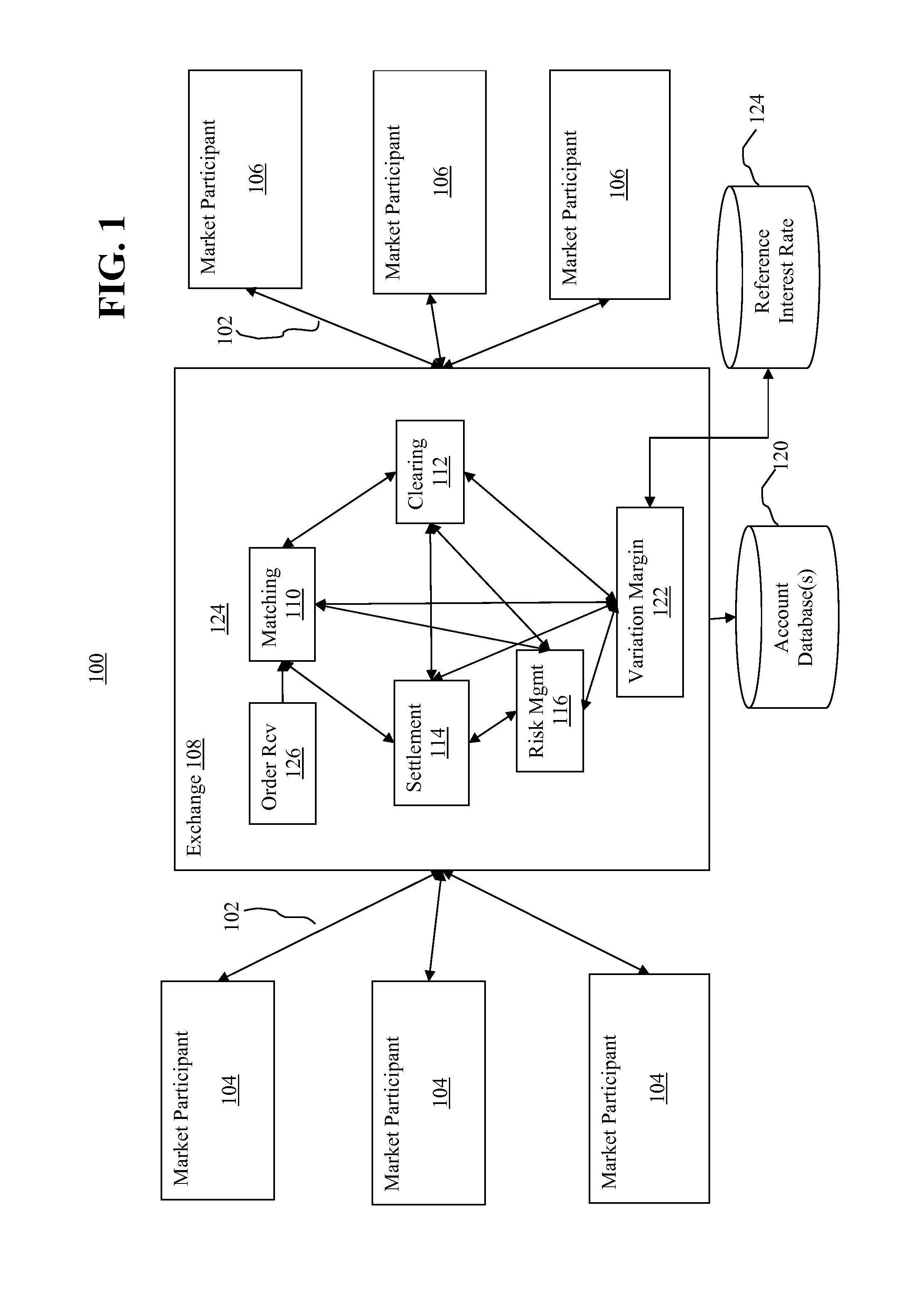

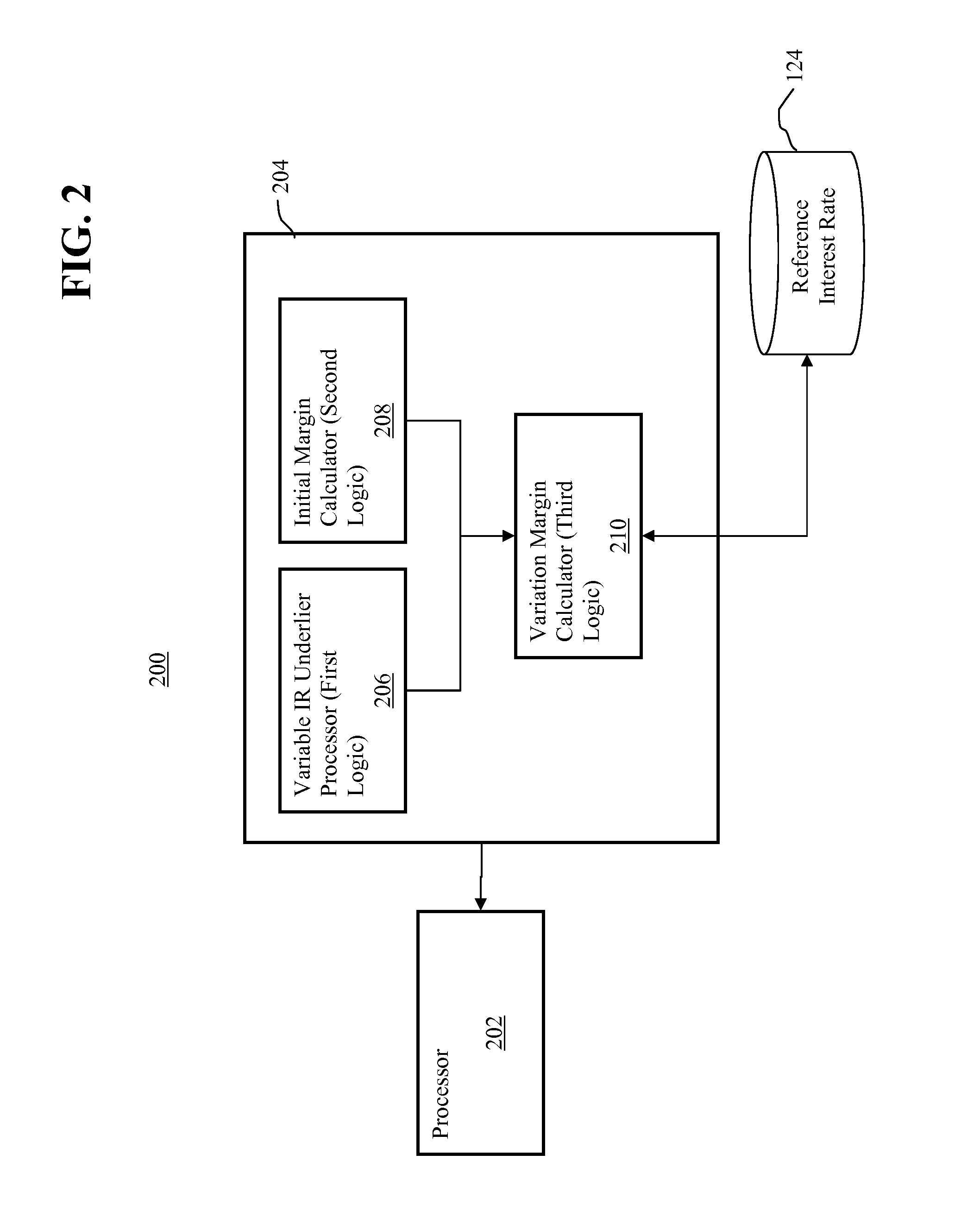

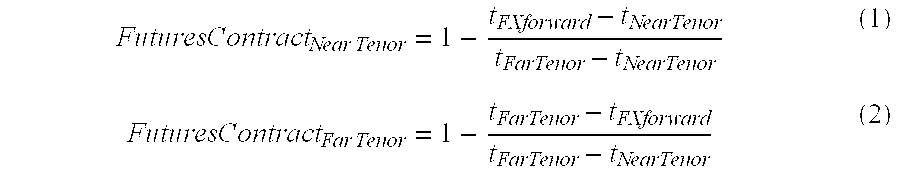

Compound overnight bank rate accrual futures contract and computation of variation margin therefore

The disclosed embodiments relate to an exchange-traded futures contract, guaranteed by a clearing house, and characterized by an embedded price dynamic comprising a compound accrual of a periodic interest rate up to a date on which trading therein is terminated, as specified in the futures contract terms and conditions. A trader may be allowed and / or enabled to take a position in a futures contract with respect to an interest bearing underlier with a variable interest rate and, thereby, minimize the number of transactions and attendant costs with respect to monitoring and correcting for divergences between the futures position and the notional interest rate swap exposure for which the futures position is intended to serve as a proxy. Variation margin for the position is computed based on an underlying reference interest rate as opposed to being computed solely on the basis of the end-of-business day price of the futures contract.

Owner:BARKER PETER +5

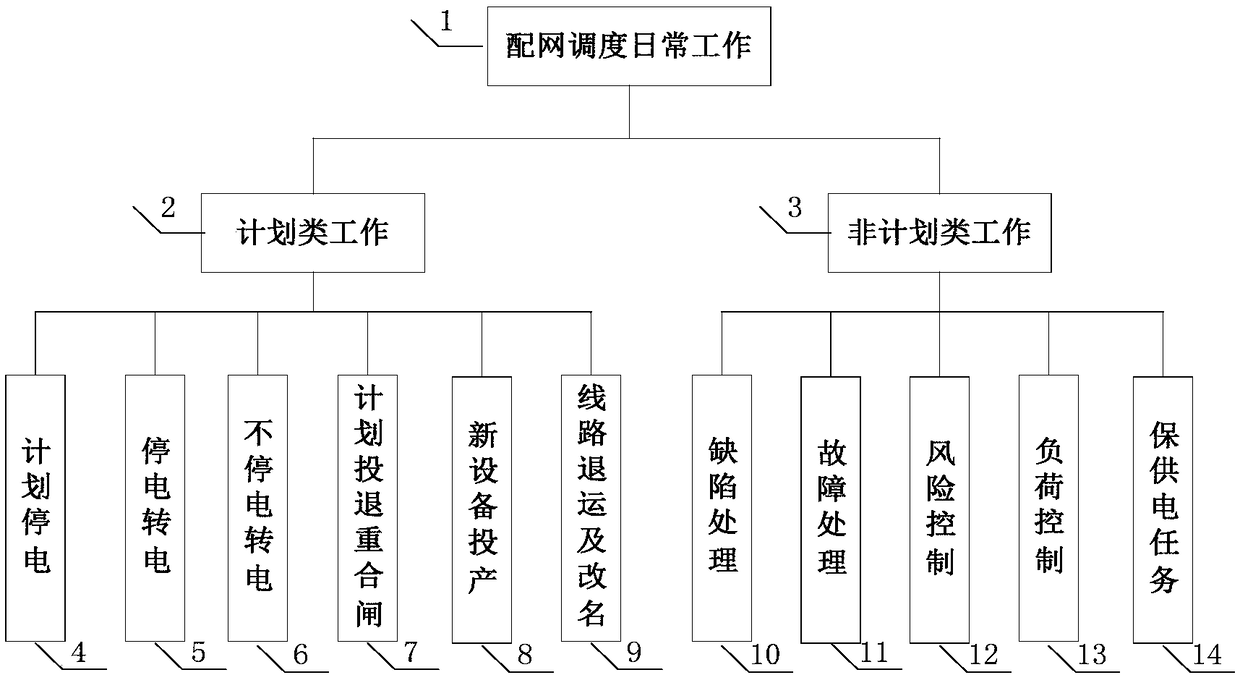

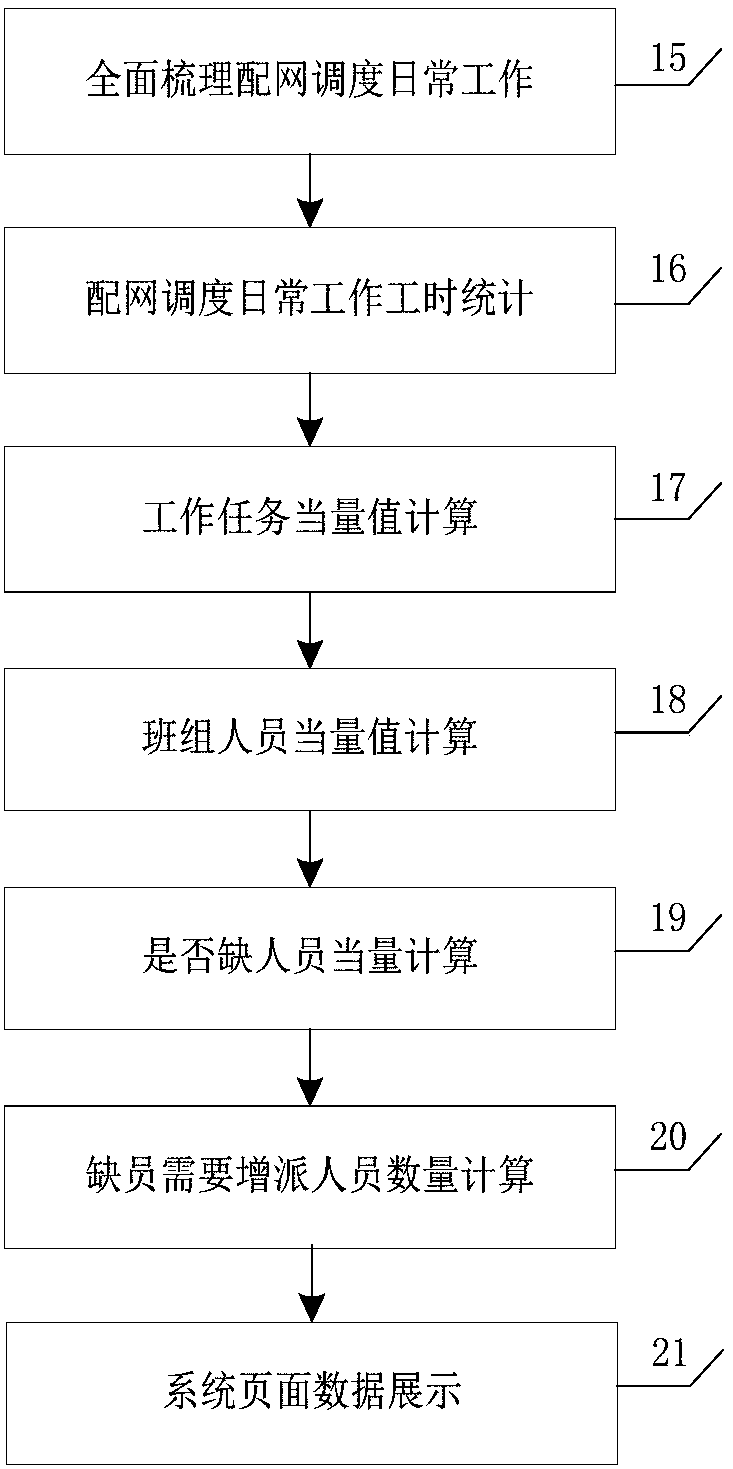

Method and system for distribution network scheduling daily workload statistics and personnel allocation

The invention provides a method and a system for distribution network dispatching daily workload statistics and personnel allocation. The method comprises the steps of: acquiring average working timeconsumption of each work through comprehensively sorting distribution network dispatching daily work services and performing big data processing analysis; meanwhile, performing comparative analysis onwork task equivalent values and team member equivalent values of a single day and time periods to obtain a conclusion indicating whether understaffing occurs the distribution network dispatching workand a number of lacked personnel; and realizing the purpose that distribution network dispatching personnel and the work task load are matched. The application of the method and the system provided by the invention changes a method of traditional distribution network dispatching with a fixed number of person on duty, achieves the effect of guaranteeing sufficient amount of personnel for distribution network dispatching daily work regardless of non-planed work excess in bad weather or planned work excess in workdays, and makes full use of human resources. The method and the system provide guarantee for the standardized and efficient work of the distribution network dispatching personnel, and realizes safe, efficient and reasonable work services.

Owner:FOSHAN POWER SUPPLY BUREAU GUANGDONG POWER GRID

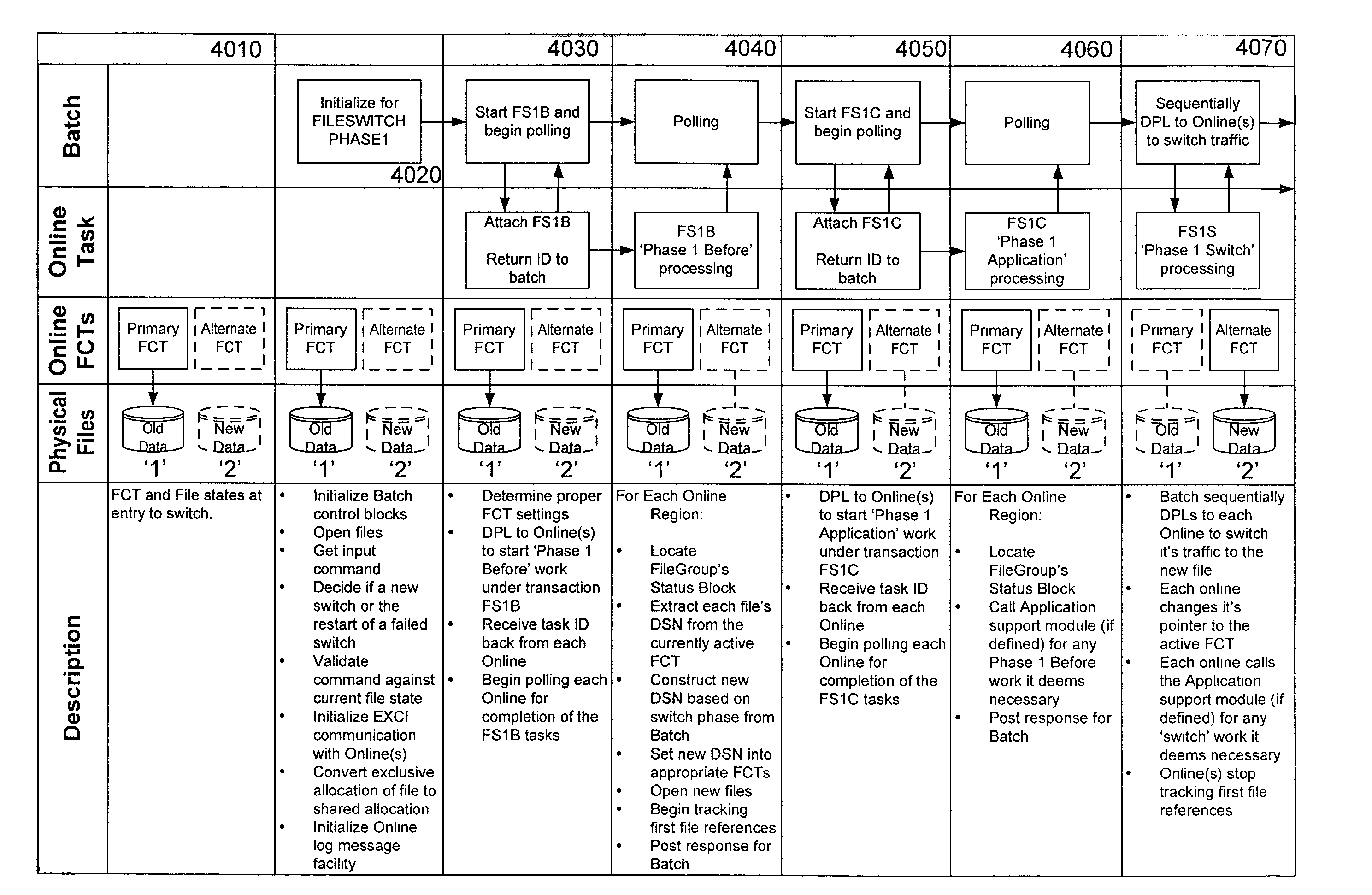

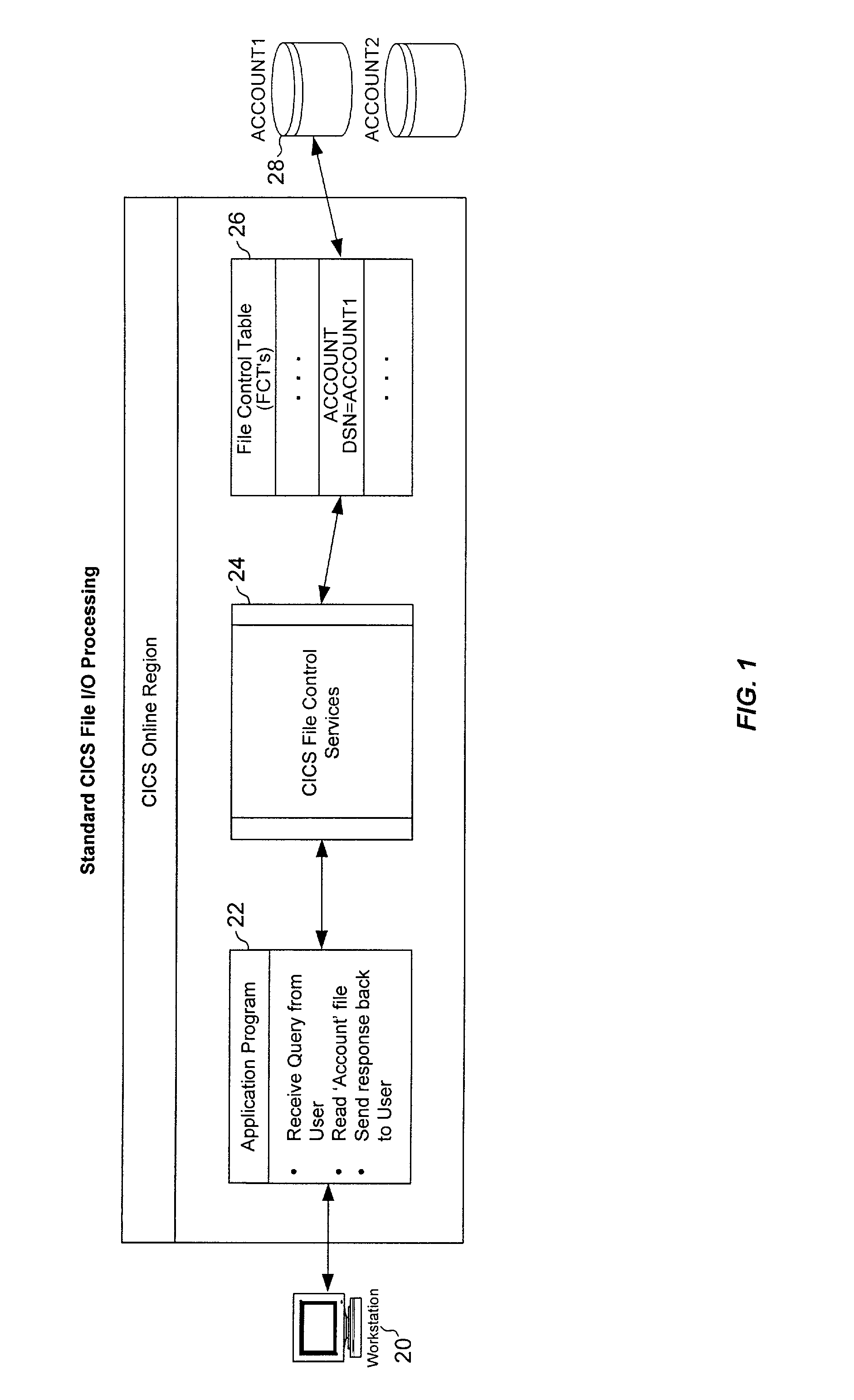

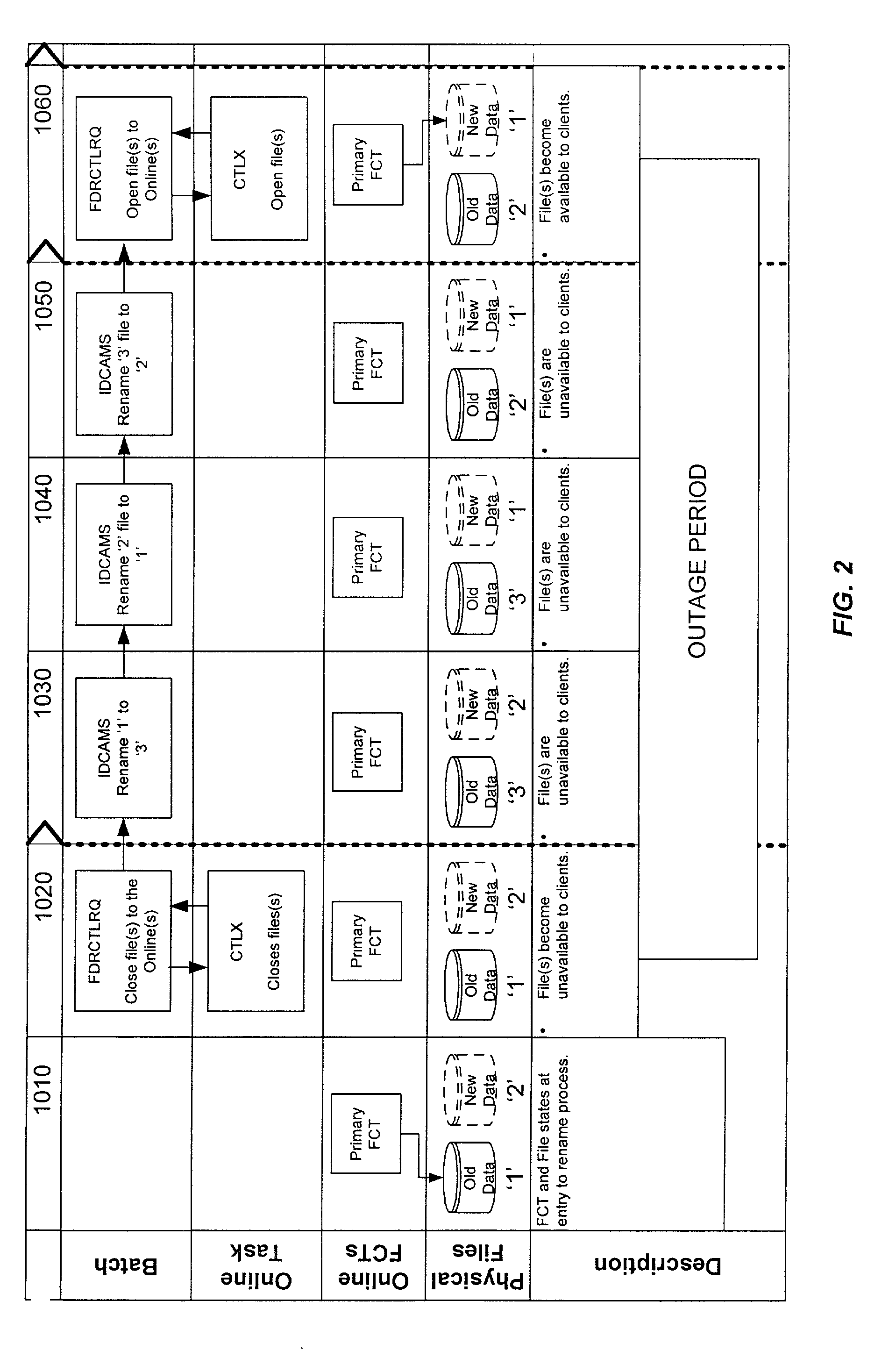

Method and system for maintaining enhanced file availability

A method and system for enhancing the availability of VSAM files is provided. According to one exemplary method performed by a batch program, a ‘1’ file is accessible to the online regions during a business day and a ‘2’ file is built with updated information. Online traffic is switched from the ‘1’ file to the ‘2’ file. The ‘1’ file is then locked up to prevent access by other batch programs. The ‘1’ file is then renamed to ‘3’ to free up the ‘1’ dataset name. The ‘3’ file (which was the old ‘1’ file before it was renamed) is opened and online traffic is switched from the ‘2’ file to the ‘3’ file. Next, the ‘2’ file is locked up to similarly prevent access by other batch programs. The ‘2’ file is then renamed to ‘1’. The ‘1’ file (which is the original ‘2’ file before it was renamed) is opened and online traffic is switched from the ‘3’ file to the ‘1’ file. Likewise, the ‘3’ file is locked up to prevent any further access by other batch programs. Finally, the ‘3’ file is renamed to ‘2’ thereby making this file available for the batch process to build the ‘2’ file with updated information during the next cycle.

Owner:FIRST DATA

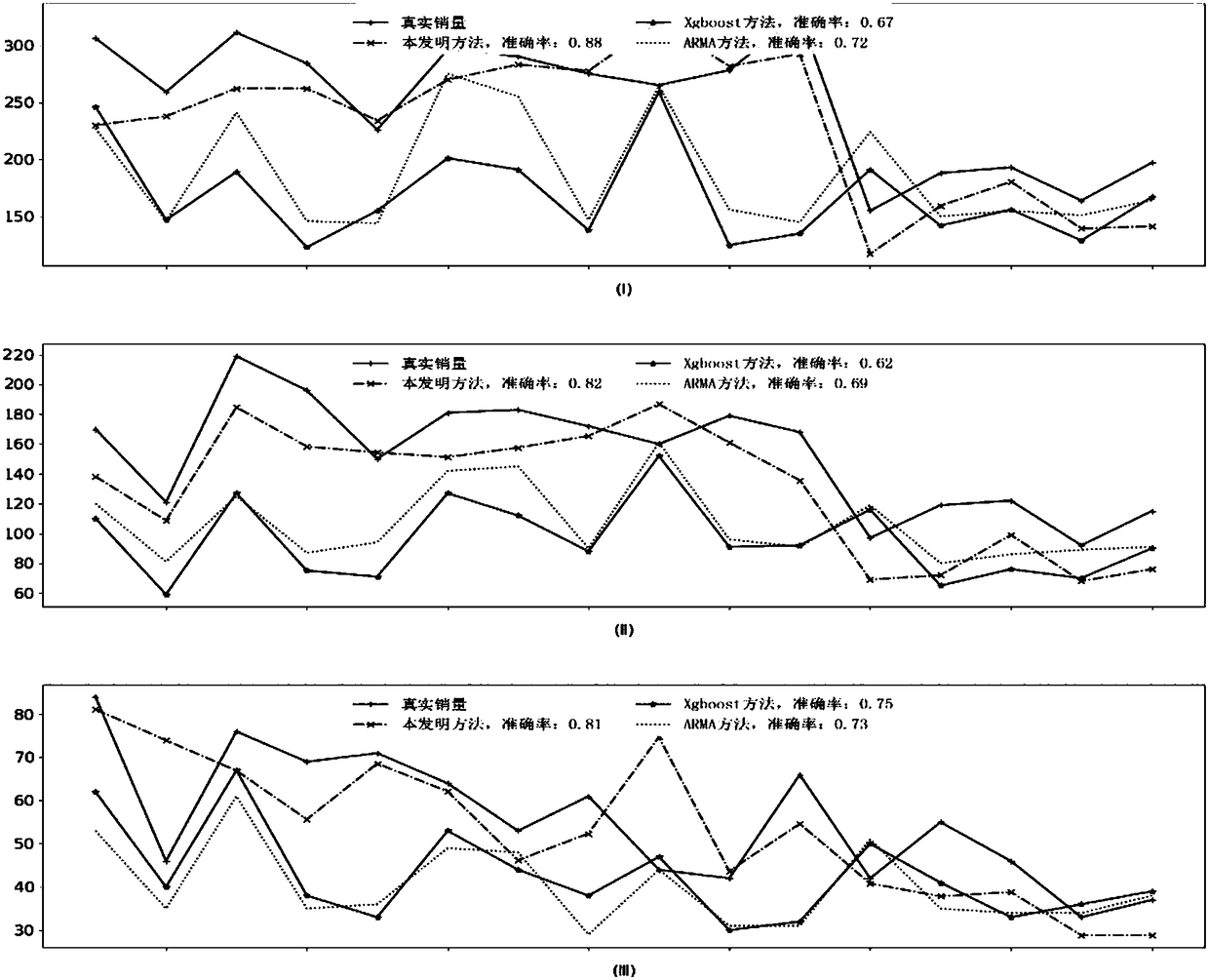

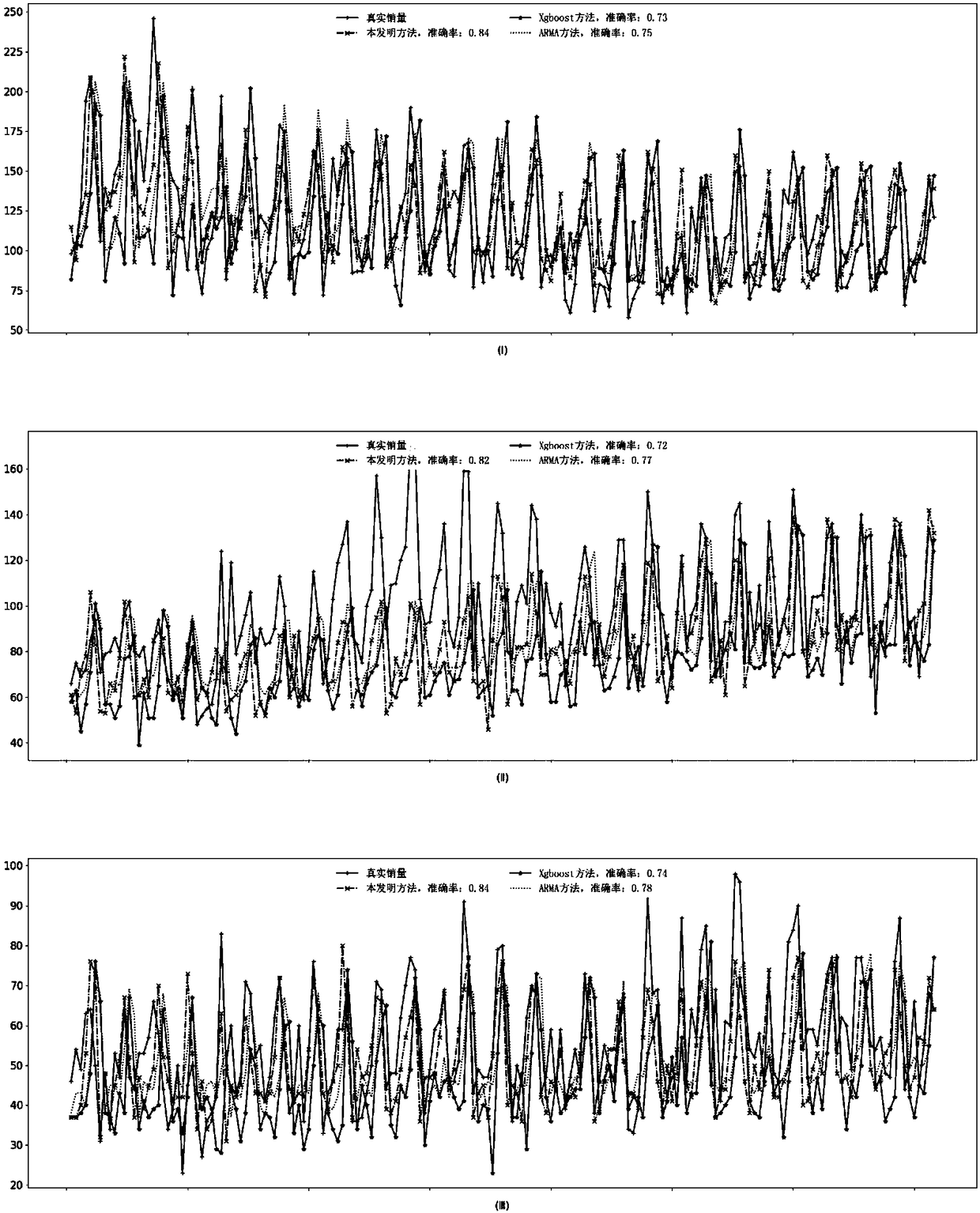

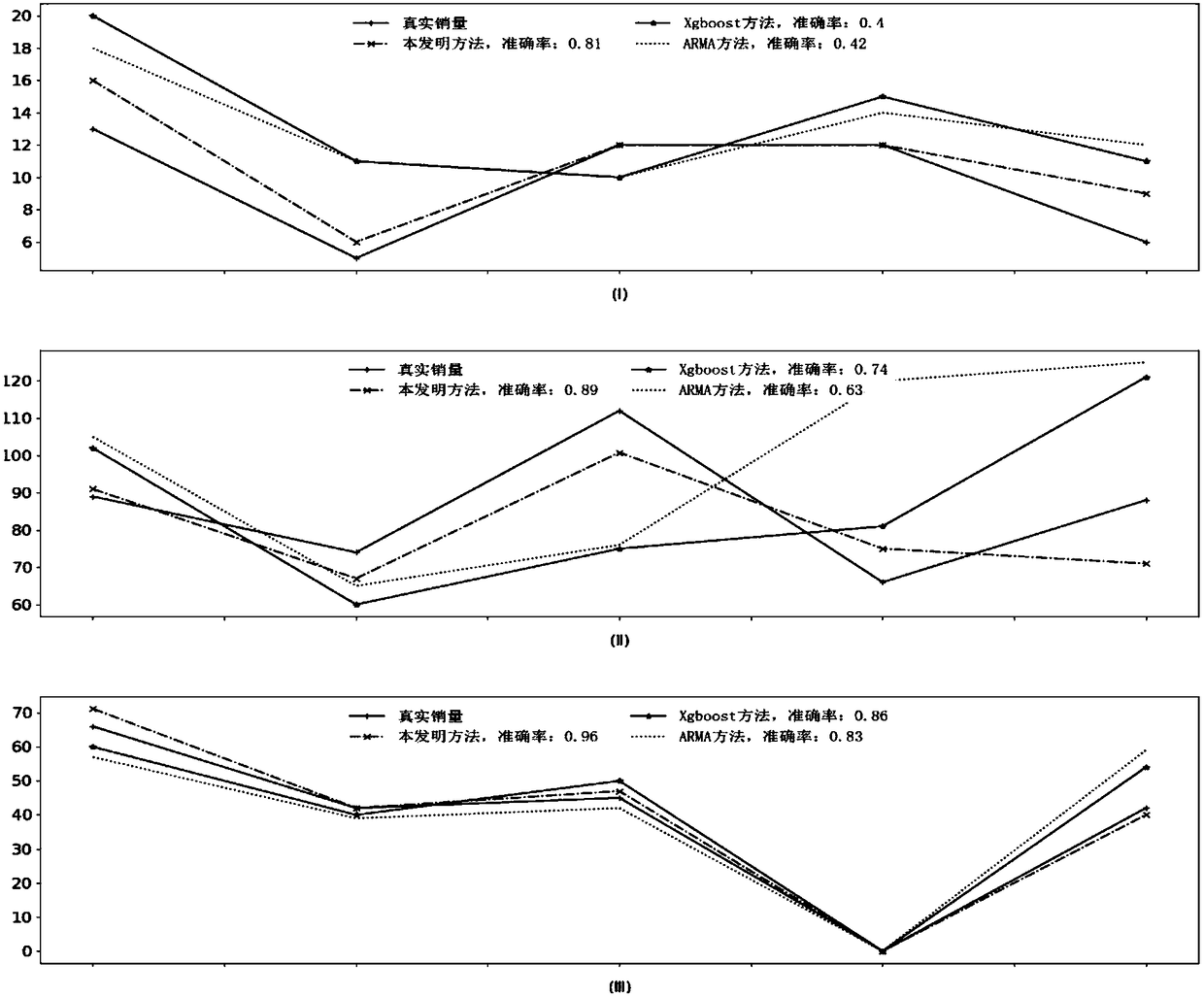

Catering industry dish sales predicting method based on deep learning

InactiveCN108364092ARich varietyMeet forecast requirementsForecastingMarketingStrong referenceEngineering

The invention discloses a catering industry dish sales predicting method based on deep learning. The method divides sales data according to the date of sales, and an ordinary working day sales predicting model and a holiday sales predicting model are established respectively. When the dish sales is predicted, the ordinary working day sales predicting model is used to predict the sales of ordinaryworking days in the future, and the holiday sales predicting model is used to predict the dish sales during holidays. According to the invention, the method performs well in both nonlinear data and holiday prediction, has the advantages of accurate prediction ability and strong robustness, and can fully reflect the regularity and characteristics of the dish sales. The predicting models can providea strong reference for the material purchase of an enterprise purchaser, and have a high application value.

Owner:XIAN UNIV OF TECH

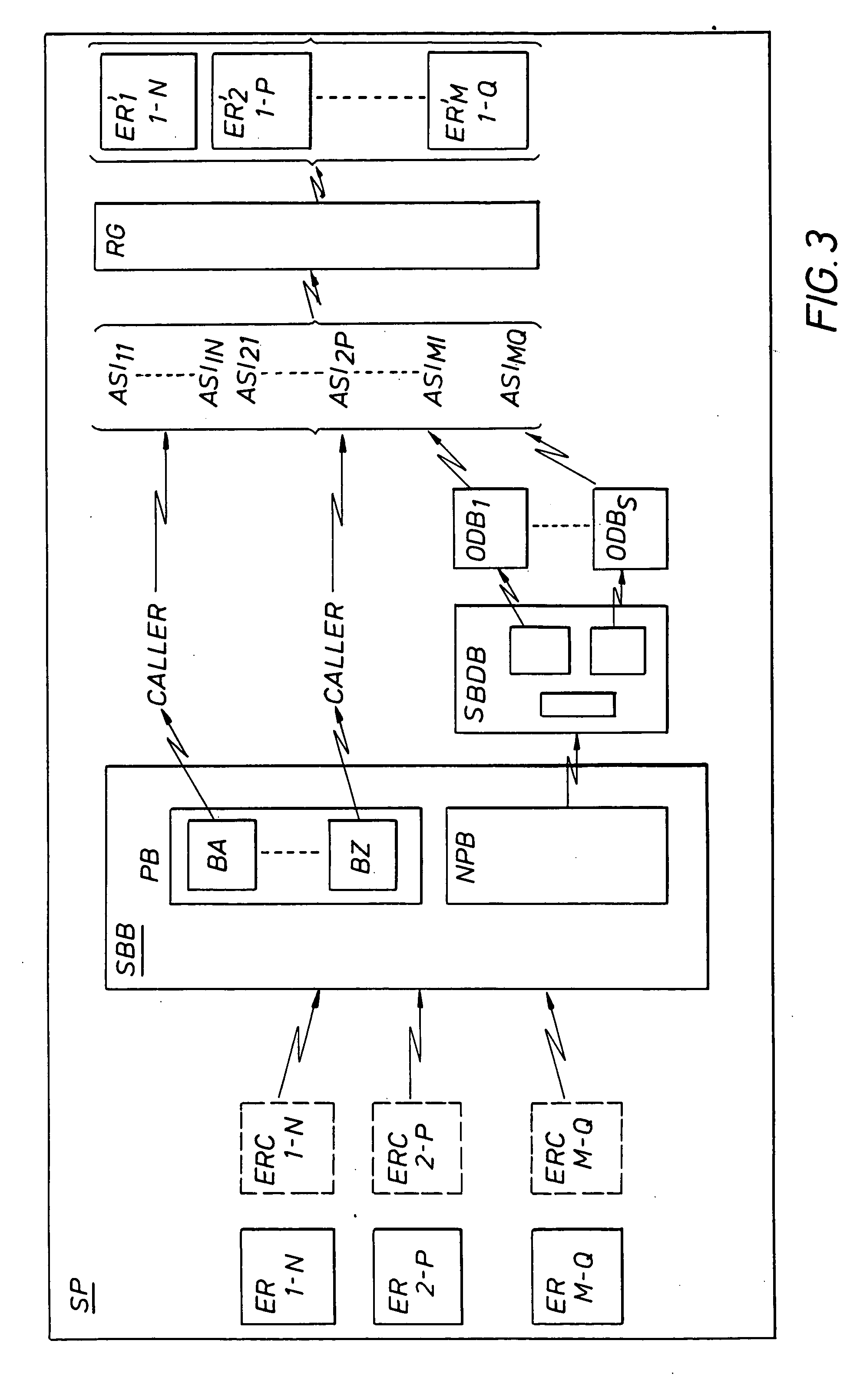

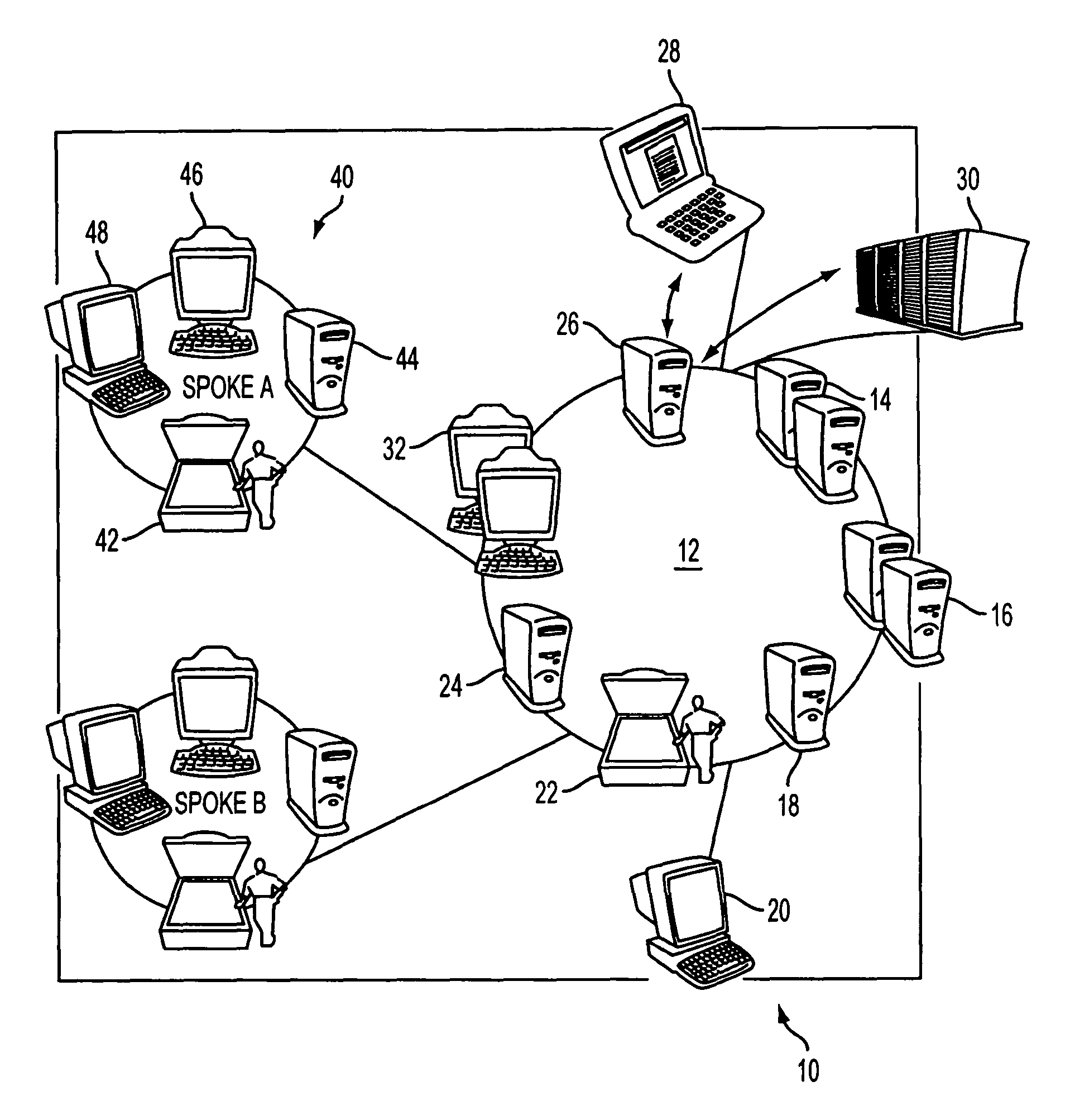

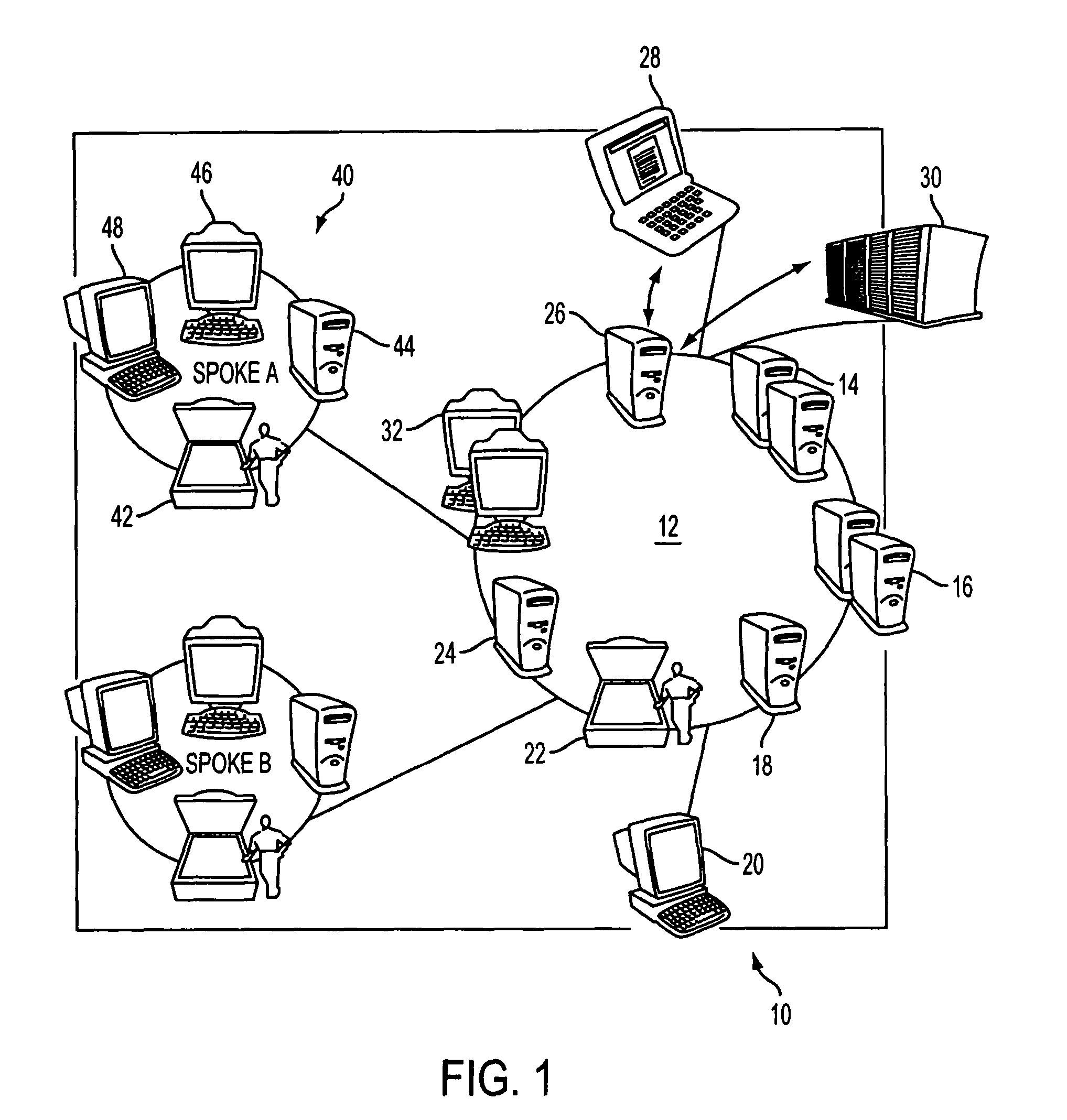

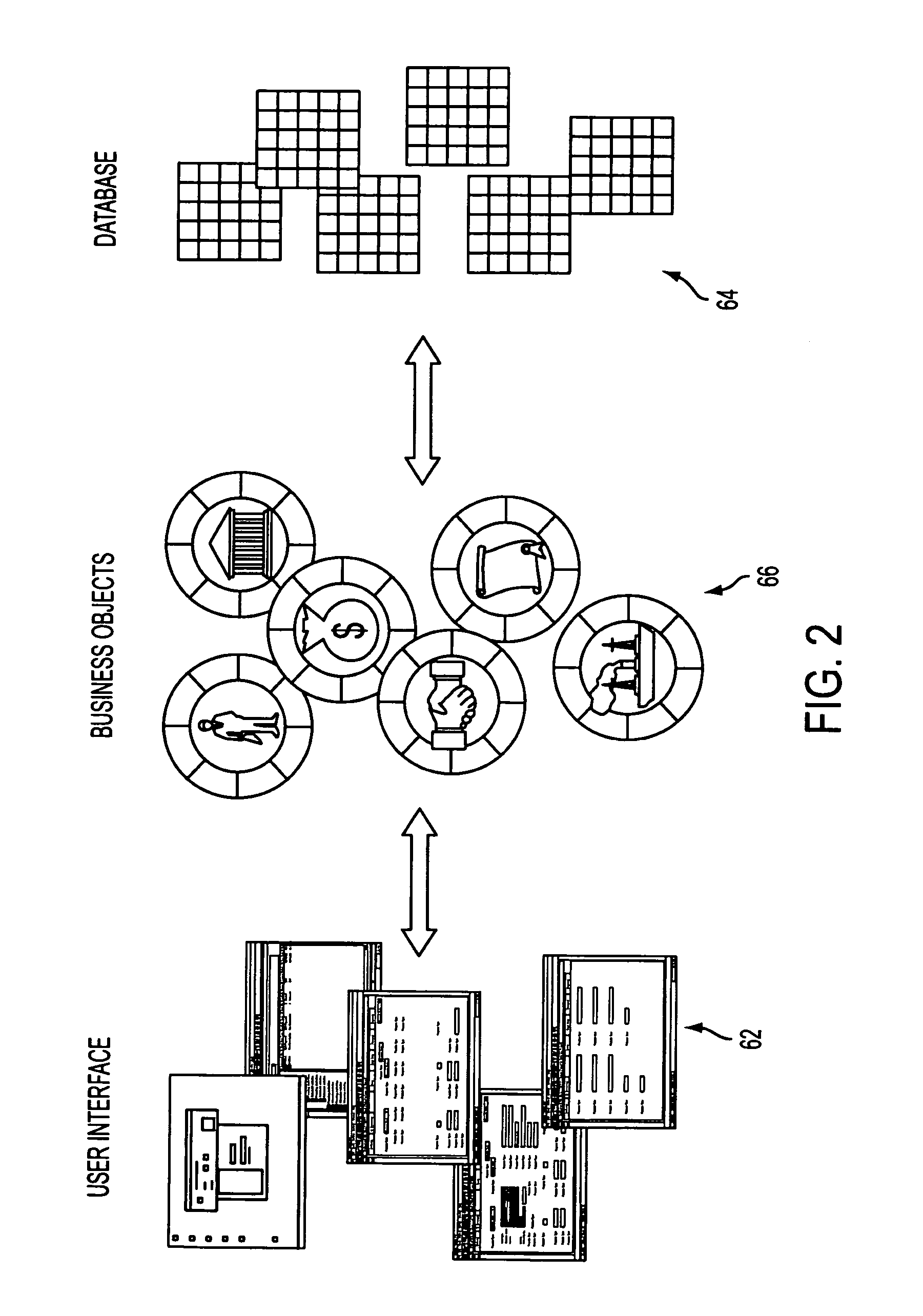

Distributed, object oriented global trade finance system with imbedded imaging and work flow and reference data

An object oriented trade finance system designed to support a large-scale transactional work flow on a global basis. The system supports all facets of the trade finance business including but not limited to letters of credit, collections, bankers acceptances and reimbursements. A trade finance system organized into a central and distributed location hardware architecture having a user interface of a user work station which communicates with an application server including business objects. The business objects communicate with a database to obtain the data needed for the business logic and include all the business logic needed for the system. Work flow distribution rules are used to distribute the work items to a work item list for work group that can be distributed geographically in different time zones and to allow processing to continue when the originally assigned workgroup has reached an end of its business day.

Owner:CGI TECH & SOLUTIONS

Retail convenience market technology with enhanced vendor administration and user mobile app functionality

InactiveUS20140316917A1Advanced technologyImprove abilitiesCash registersPoint-of-sale network systemsMobile appsWorkspace

A self-service, self-checkout micro-market retail shopping system for disposition and use in a private or public office, factory or other workspace for use by employees, workers and the like. The micro-market may supply snacks, candies, beverages, other food items and various convenience items such as toiletries for use by employees, workers and other during the work day, lunch and break time. The micro-market may also supply work related items such as uniforms and apparel, tools, office supplies, travel accessories and the like. The devices and process also include enhanced vendor administration tools and functionality. The devices and process also include enhanced user ability to use mobile devices and apps, and on-line tools for creating and managing accounts and for purchasing items.

Owner:TW VENDING

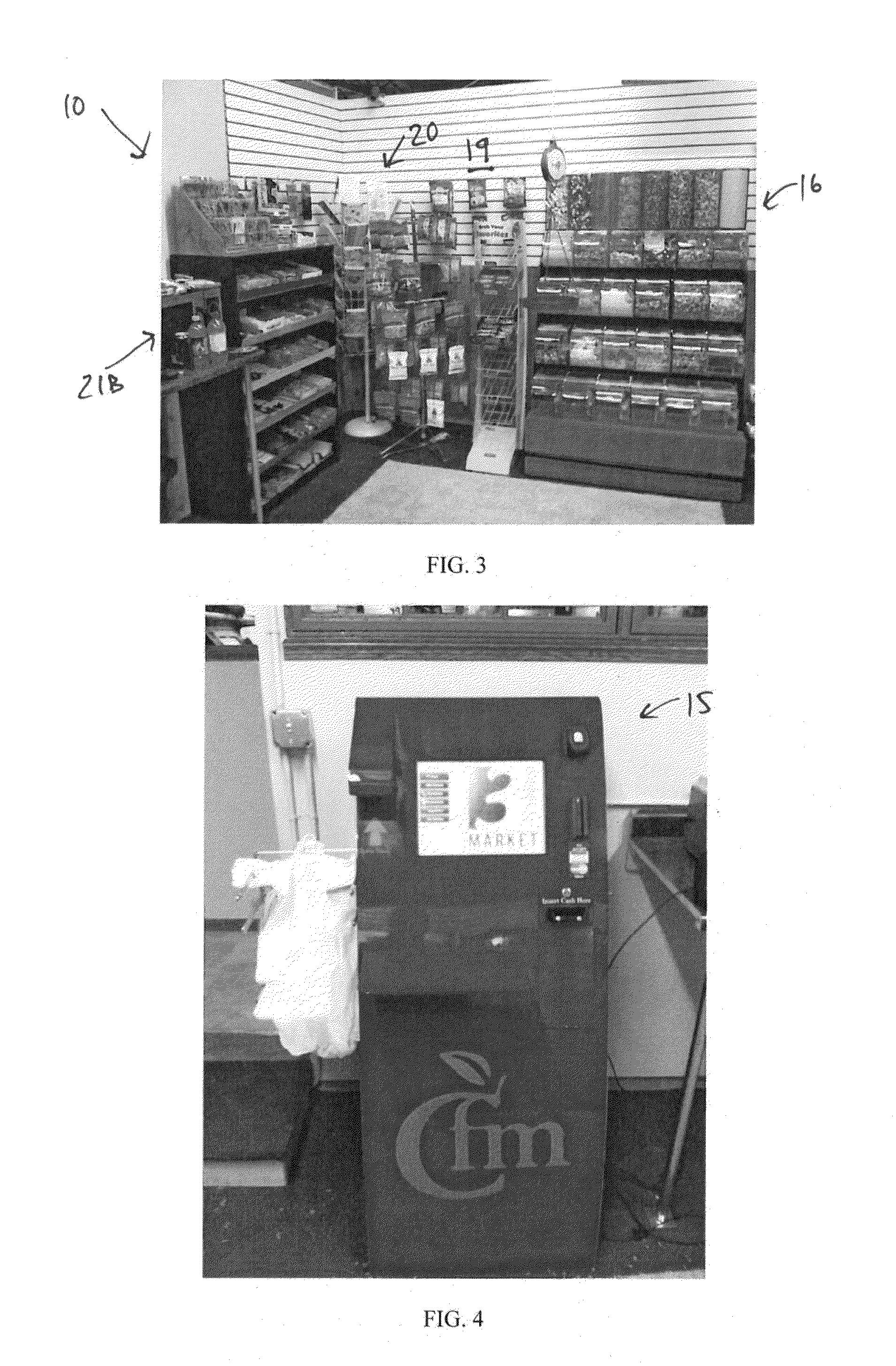

Commuting private car dynamic car-sharing recommendation method

ActiveCN107038858AImprove carpool satisfactionReduce waiting timeData processing applicationsRoad vehicles traffic controlCar sharingMorning

The invention discloses a commuting private car dynamic car-sharing recommendation method. The commuting private car dynamic car-sharing recommendation method comprises steps that license plates are input, and data is automatically identified, and is preprocessed to generate a car trajectory set; based on the urban vehicle trajectory set, by combining with the high repeatability and the periodicity of the time-space rules of the commuting private cars, a workday commuting private car identification algorithm is designed; by combining with the home-work addresses, the commuting time windows, and the workday dynamic influence factors (weather, accidents, and traffic)of the commuting private cars, the key characteristics affecting the car-sharing of the commuting private cars are extracted; based on the space-time characteristics of the commuting cars, the commuting cars having the similar commuting time-space rules are matched with each other, and by combining with dynamic influence factors affecting car-sharing wills of drivers, the dynamic factors are effectively combined with car-sharing demands of users in a time-space dimension, and therefore the dynamic car-sharing matching based on the wills of the users is realized, a long-term stable car-sharing mechanism is provided for the commuting private cars, and then the number of the private cars in the morning and evening rush hours is obviously reduced.

Owner:XIAMEN GNSS DEV & APPL CO LTD

Mapping an over the counter trade into a clearing house

A method and system converts OTC positions into contracts clearable at a futures clearing house. Each OTC position has a maturity date. The method comprises: a) defining a plurality of tenors. The plurality of tenors is fewer in number than the OTC maturity dates of the OTC positions. The method also comprises: b) defining a contract, which is clearable at the clearing house, corresponding to each tenor defined in step a); c) mapping each OTC position, as it is executed, into one or more of the contracts, based on the maturity date of the OTC position; and d) between business days, re-mapping each contract mapped at step c) to account for the move of calendar day. The invention finds particular application as a method and system to convert OTC Foreign Exchange (FX) positions into futures contracts clearable at a futures clearing house. The OTC FX positions may include OTC FX spot positions and OTC FX forwards positions.

Owner:CME GRP

Retail convenience market technology with enhanced vendor administration and user mobile app functionality

ActiveUS9171300B2Advanced technologyImprove abilitiesCash registersBuying/selling/leasing transactionsMobile appsWorkspace

A self-service, self-checkout micro-market retail shopping system for disposition and use in an private or public office, factory or other workspace for use by employees, workers and the like. The micro-market may supply snacks, candies, beverages, other food items and various convenience items such as toiletries for use by employees, workers and other during the work day, lunch and break time. The micro-market may also supply work related items such as uniforms and apparel, tools, office supplies, travel accessories and the like. The devices and process also include enhanced vendor administration tools and functionality. The devices and process also include enhanced user ability to use mobile devices and apps, and on-line tools for creating and managing accounts and for purchasing items.

Owner:THREE SQUARE MARKET INC

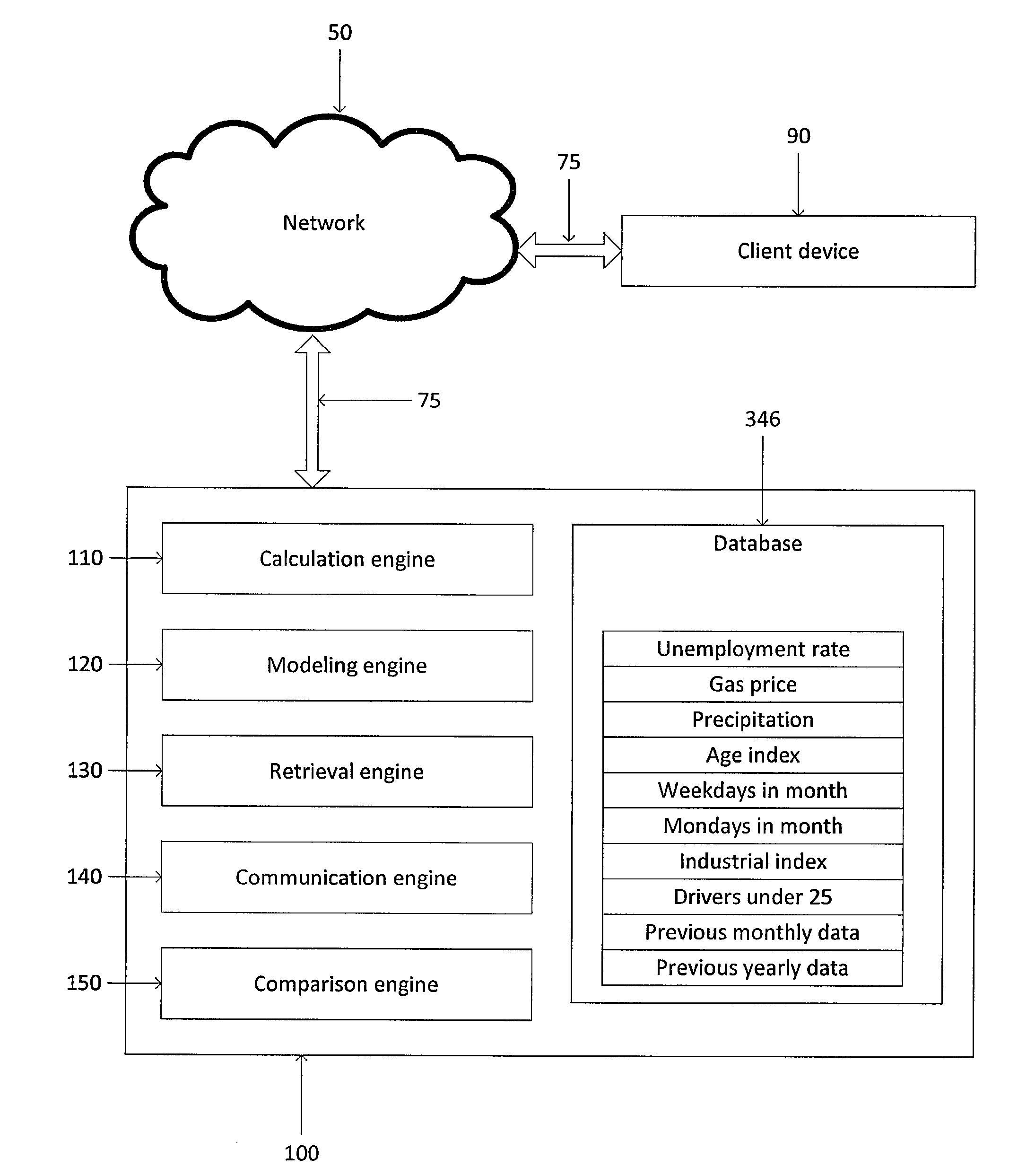

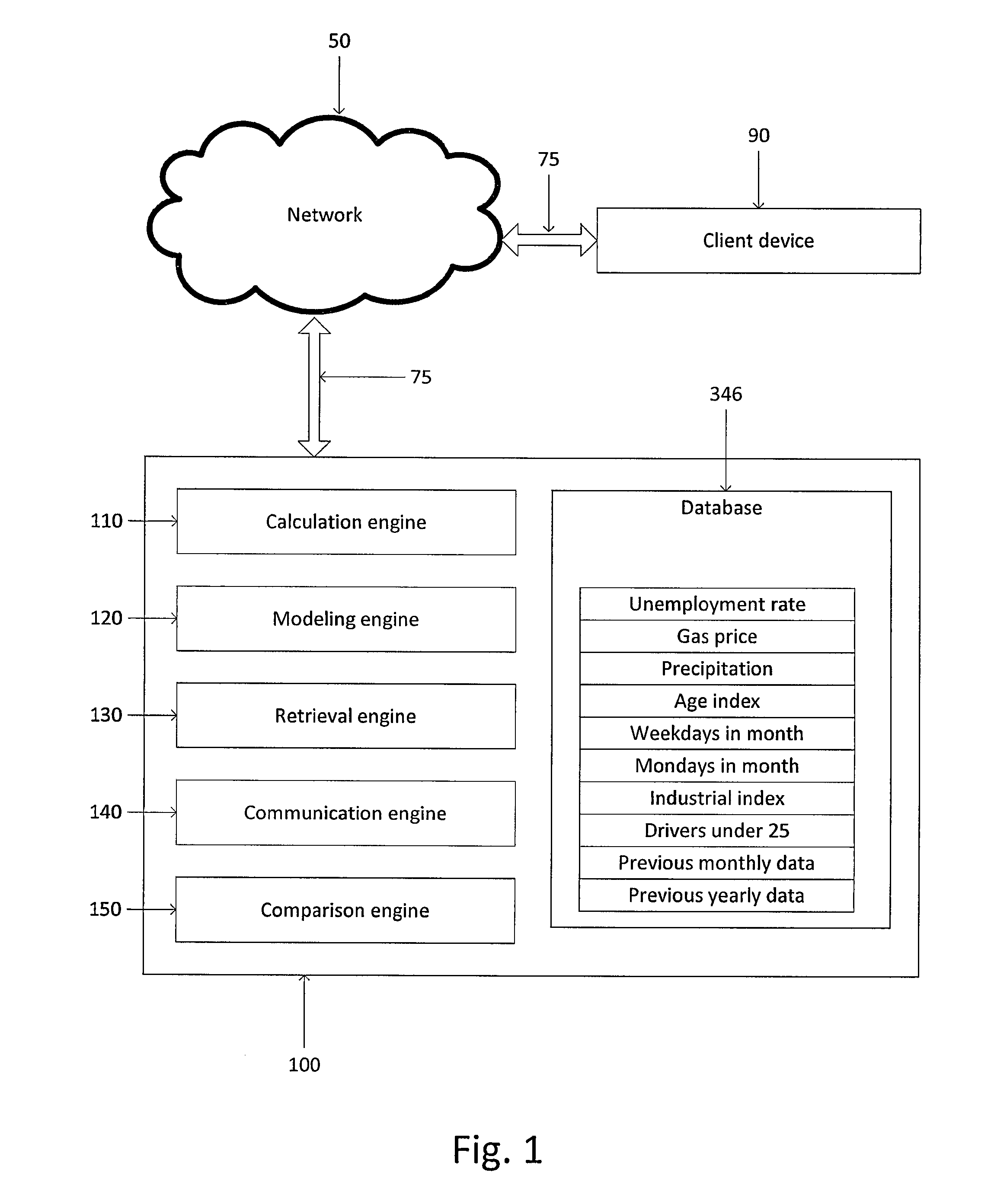

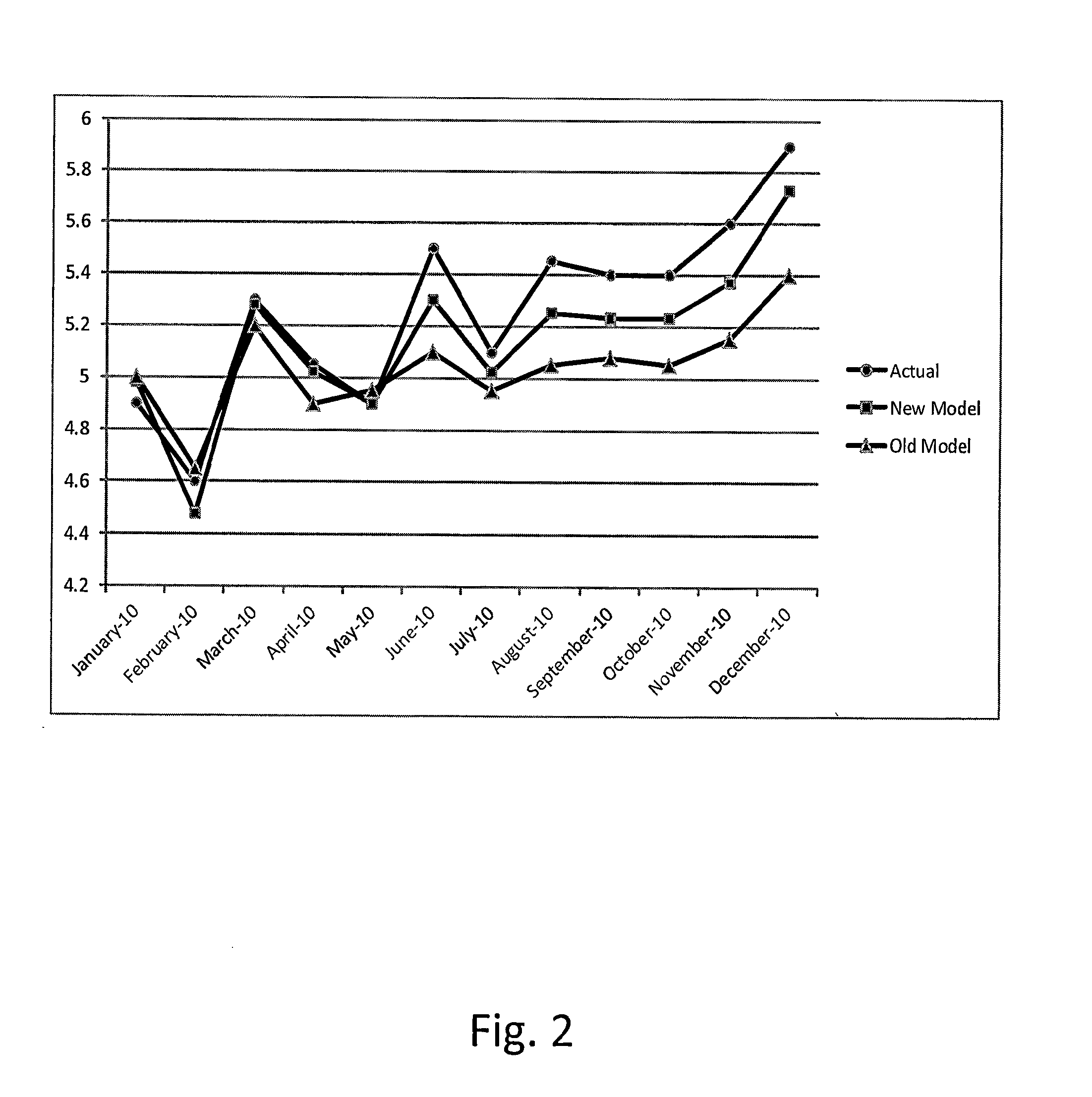

Systems and methods for utilizing an economic model that incorporates economic influences to predict transactions

Systems and methods for utilizing models that incorporate economic influences to predict transactions and / or events. In one embodiment, a method is described that generates a predictive model that may incorporate economic influences, such as weekdays in a month, lagging economic indicators such as unemployment data, leading economic indicators such as an industrial index, energy costs such as the price of gas, and real-world events such as precipitation, and utilizing the predictive model to predict events such as car insurance claims.

Owner:USAA

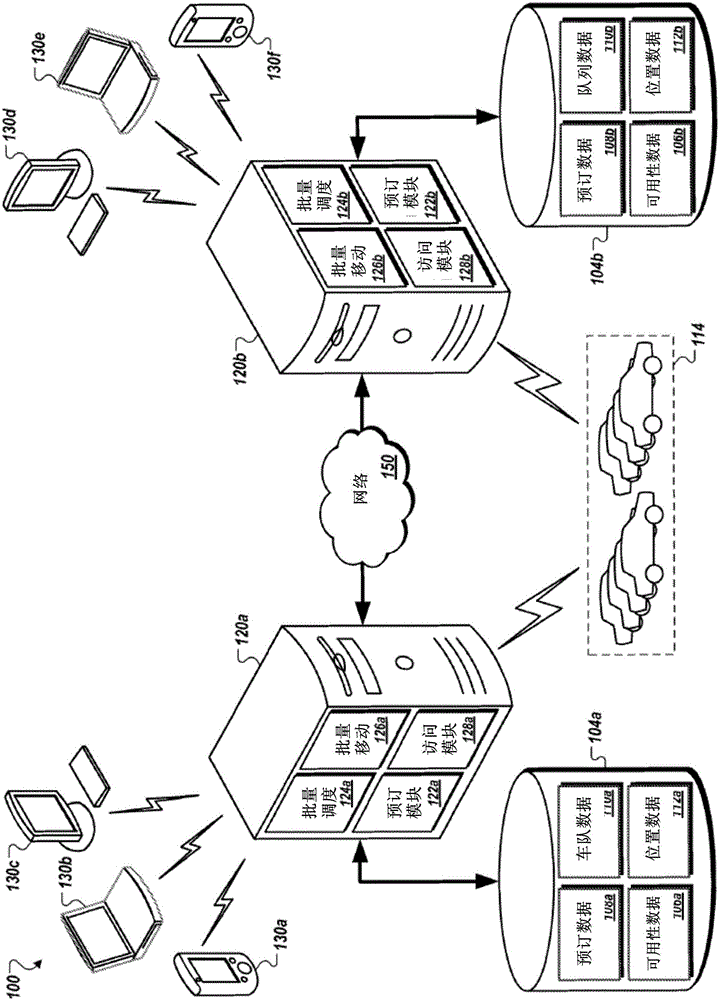

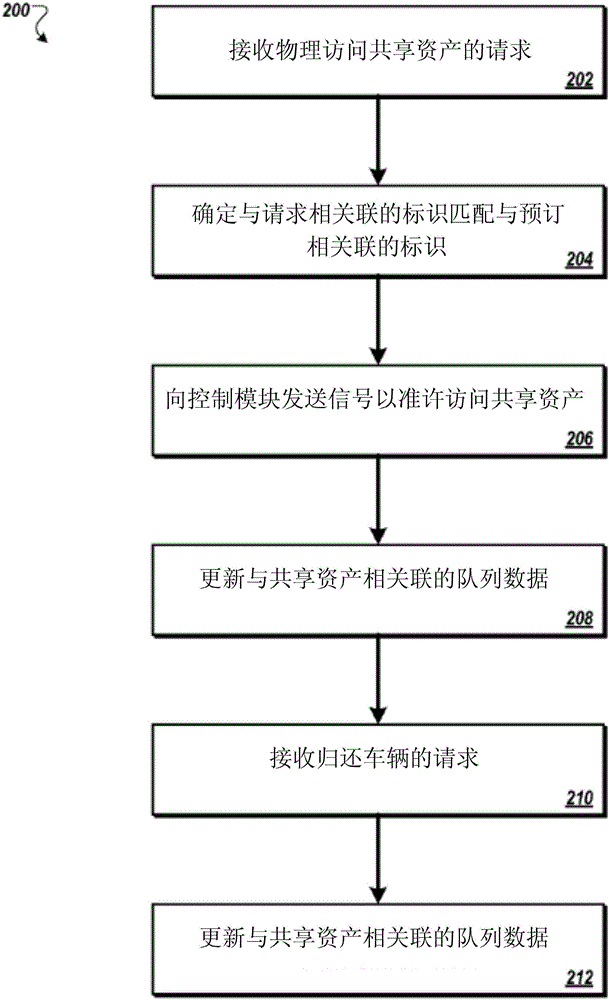

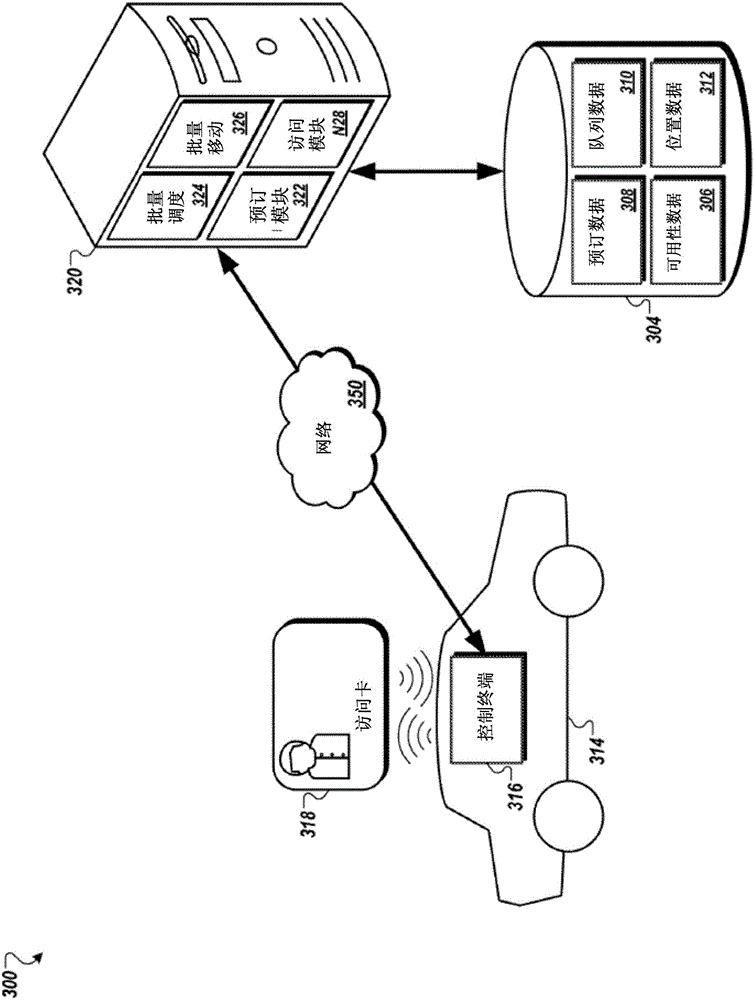

Systems and methods for vehicle fleet sharing

The disclosed technology relates generally to methods and systems for sharing vehicles between fleets. Vehicle sharing services typically experience the most use during the weekend. Thus, many vehicles used by vehicle sharing services sit idle during the week. Meanwhile, vehicle rental companies experience the most demand during the week and their vehicles are underutilized during the week. The disclosed technology, in certain embodiments, provides systems and methods for sharing vehicles between a vehicle sharing entity and a vehicle renting entity. This allows the entities to lower fleet costs and obtain better fleet utilization by moving vehicles between fleets when one entity anticipates a spike in demand. For example, the ability for the vehicle sharing service to utilize a rental vehicle agency's excess weekend inventory will allow them to meet its strong weekend demand without the need for purchasing and maintaining additional vehicles.

Owner:热布卡公司

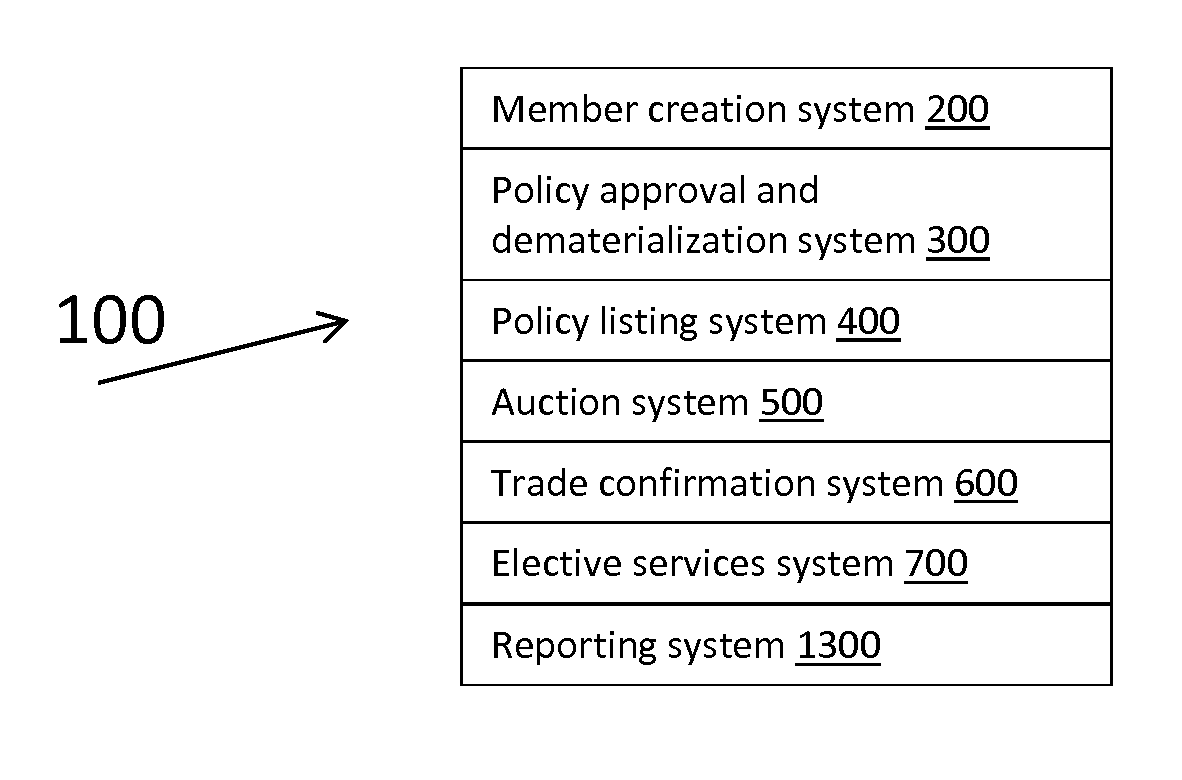

System and method for trading senior life settlement policies

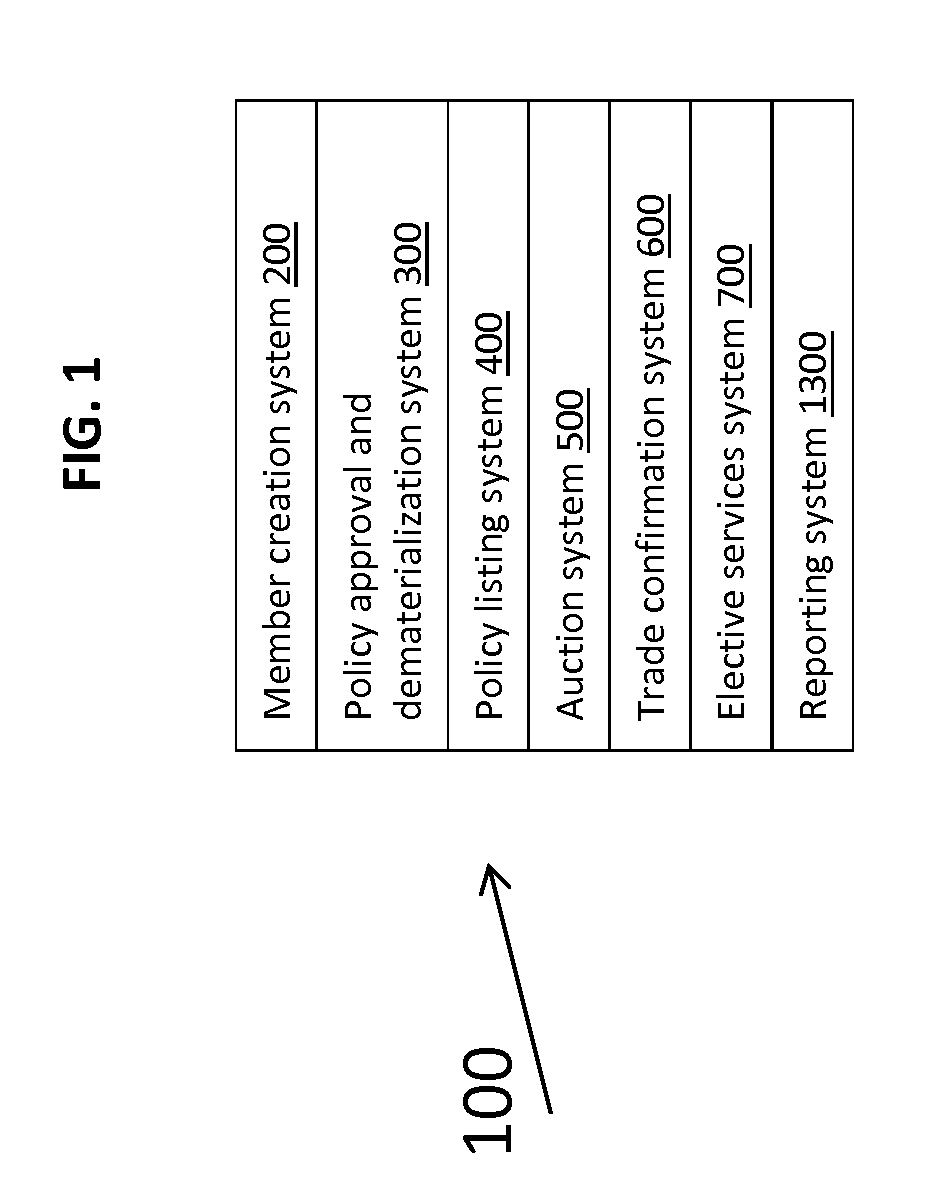

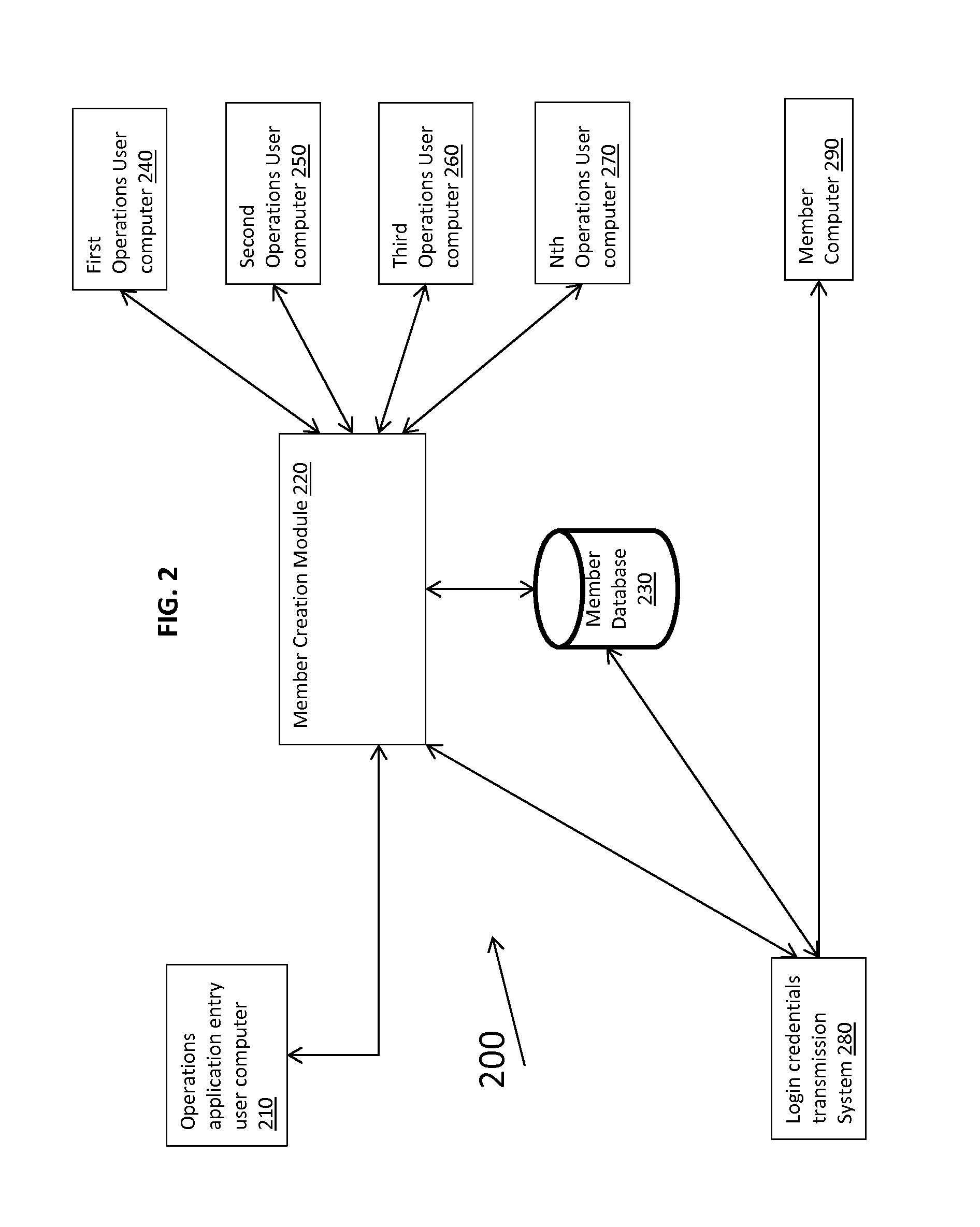

A system and method for an exchange for auctioning senior life settlement policies are provided. The system and method may include a member creation system for approving new members, a policy approval and dematerialization system for approving and dematerializing a senior life settlement policy prior to being made available for auction, a policy listing system for selecting an approved and dematerialized senior life settlement policy for auction and for entering dynamic policy data to govern the auction for the selected senior life settlement policy, an auction system for accepting bids and determining whether an auction has been successful or whether an auction needs to be extended, and a trade confirmation system for confirming successful auctions and for tracking settlement of transactions which must occur within three business days of the date of auction.

Owner:GUNN JOHN

Methods, Apparatus, and Systems for a Global Equity Exchange

Systems, software, financial exchanges, and methods for a new global finical exchange are described. In one aspect, the present invention provides an exchange that lists sector, country, regional, and world electronically traded electronic representations of instruments on a set of representative global equity indices based on a single source, on an electronic exchange, open nearly 24-hours every business day, in one base currency, with periodic (annual) normalized index prices, utilizing a unique share-sized derivatives instrument as described in U.S. patent application Ser. No. 13 / 074,687, having cross margining, yearly expirations, associated options, and realized volatility instruments. All of these features combined into one comprehensive package will attract market participants because of a better-designed product, utilizing capital in the most efficient way possible, with features not found, or not commonly found, on any exchange, and with many cost-saving elements. The present invention could be the first credible threat to the dominance of the handful of mega exchanges in the U.S. and Europe.

Owner:VOLATILITY PARTNERS

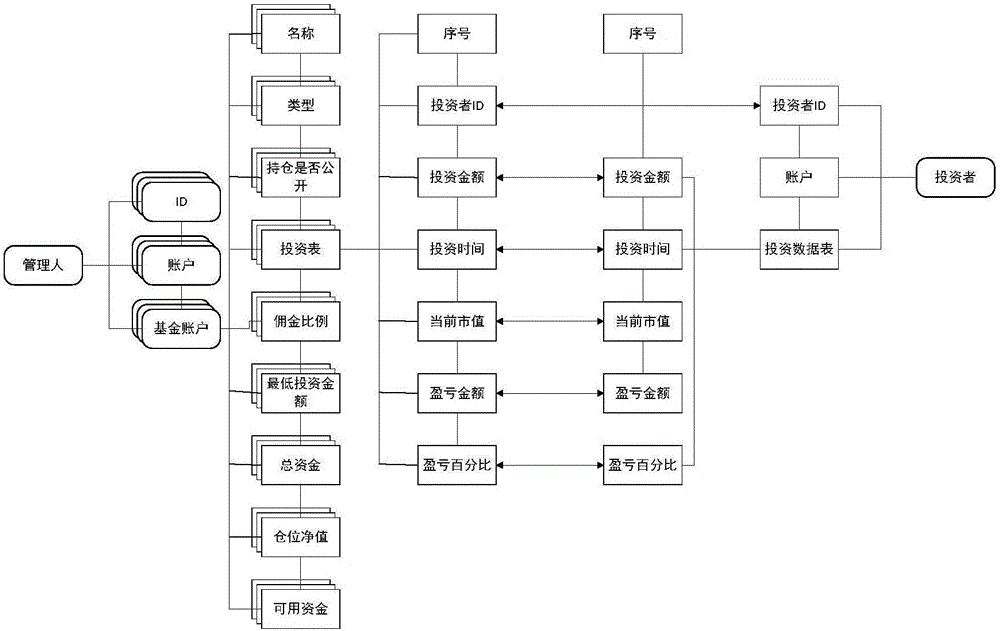

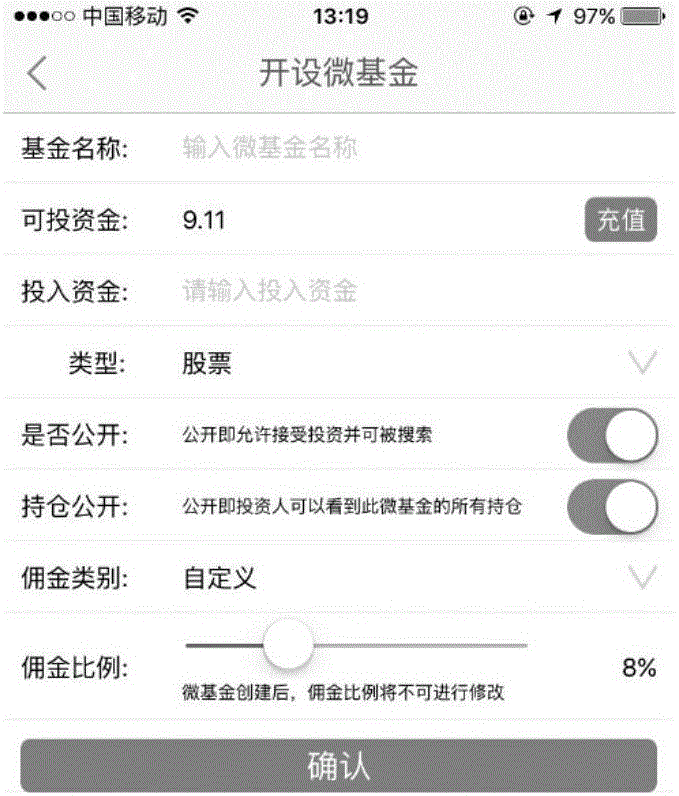

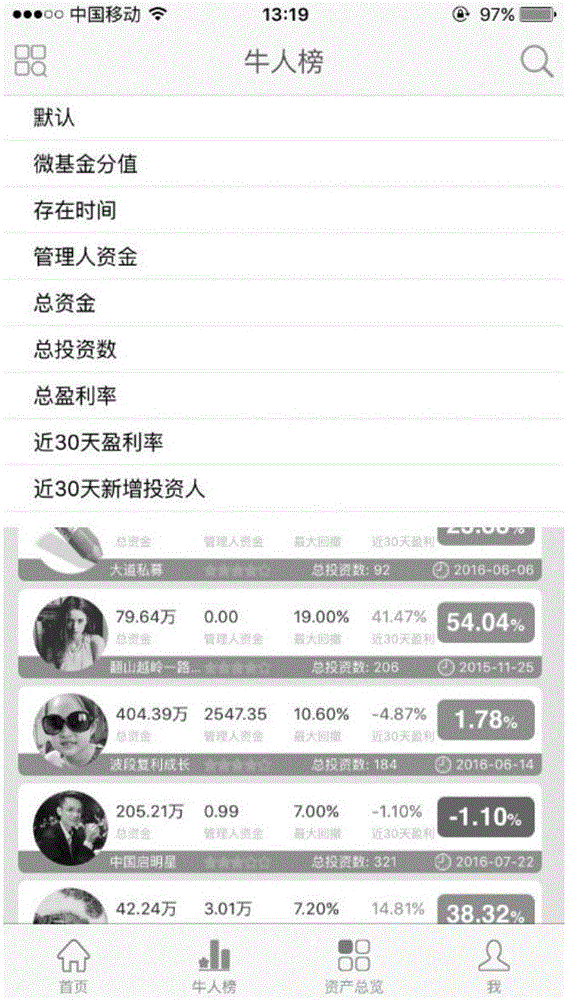

Open-ended type fund implementation method enabling capital withdrawal at any time

The present invention discloses an open-ended type fund implementation method enabling capital withdrawal at any time. The method includes the following steps that: 1, a system configures a unique ID and account for a manager and an investor; 2, the fund manager applies for initiating an open-ended type fund, the fund system processes the application of the fund manager; 3, the investor retrieves the fund according to different sporting modes based on his or her own needs and initiates an investment application containing a clear amount of money, the system checks the investment application; and 4, after investing the fund, the investor initiates a capital withdrawal and redemption application, the fund system processes the capital withdrawal application, and a transaction is completed. With the method of the present invention adopted, the investor can complete the transaction after submitting subscription and buying or capital withdrawal and redemption without the confirmation of the fund manager required; capitals can be transferred into an account on the same day; the speed of capital utilization can be increased; the waiting time of the completion of input and redemption transactions can be decreased; the commission settlement, the transfer of commissions to the account of the manager, and the capital withdrawal of the investor can be completed simultaneously; and time for commission settlement and the transfer of the commissions to the account can be reduced to zero.

Owner:杭州众基网络科技有限公司

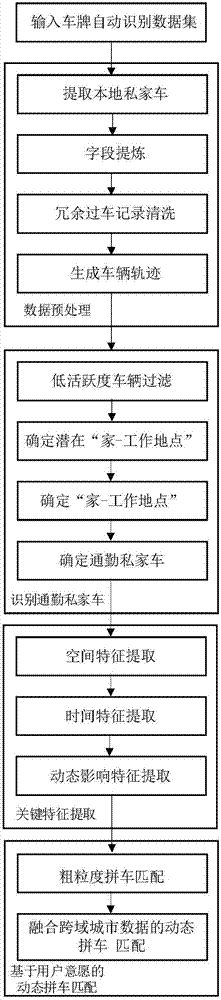

Capacity planning method and system

A capacity planning method and system determines whether an organization has sufficient staff to perform tasks. The method and system identify each of a plurality of tasks to be performed by the organization, and identify subtasks associated with each of the plurality of tasks. Production rate information related to the amount of time or the number of staff needed to perform each of the identified subtasks is then determined. Based on the identified subtasks and the production rate information, a work volume is calculated. Staff availability is determined based on staff information related to the number of employees, identities and positions of employees, exempt status of employees, staff outage, the amount of work time that cannot be used to perform the subtasks, the amount of business days, and / or the amount of defined work hours per day. A capacity report is then generated based on the work volume and the staff availability.

Owner:PERSHING INVESTMENTS

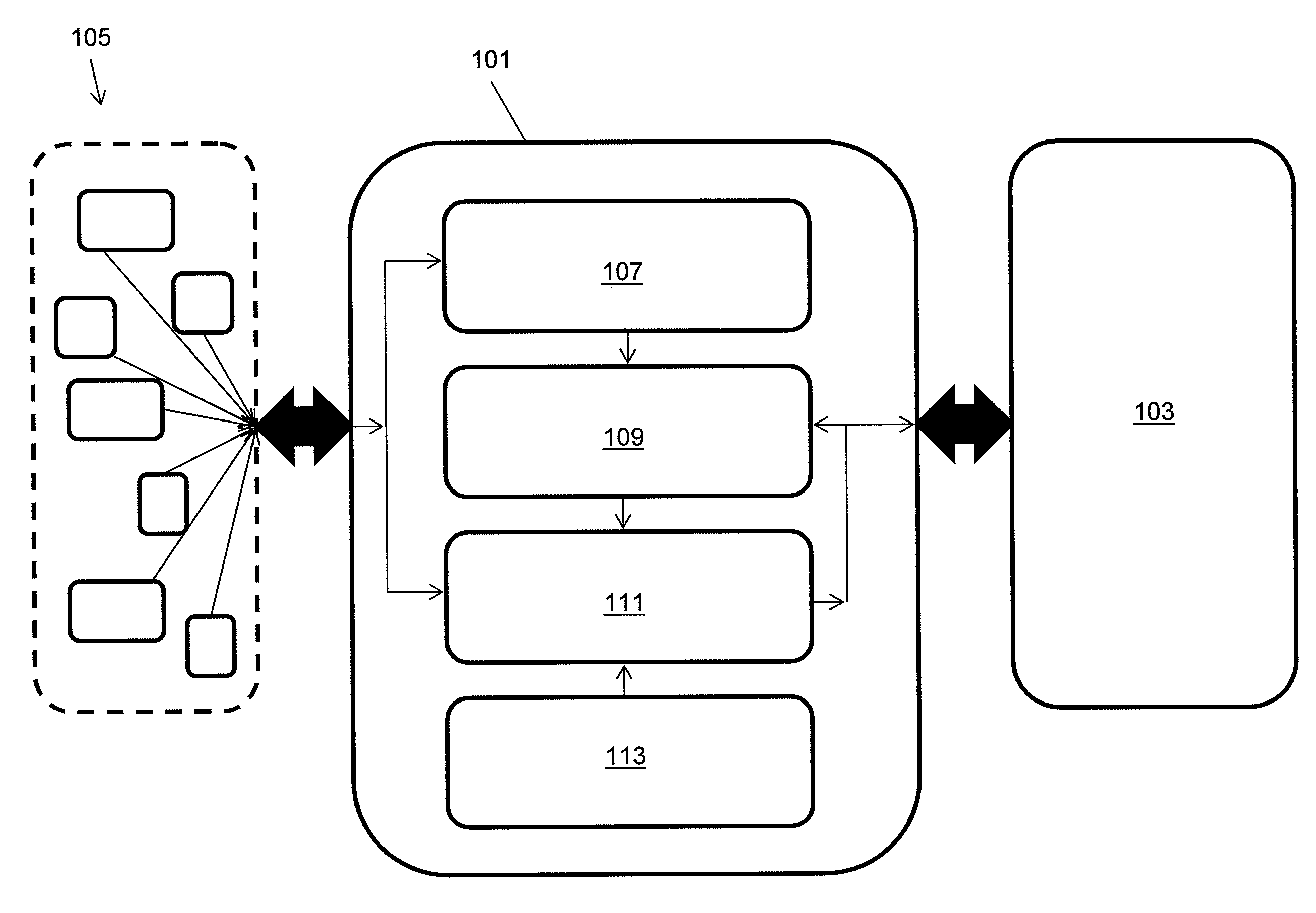

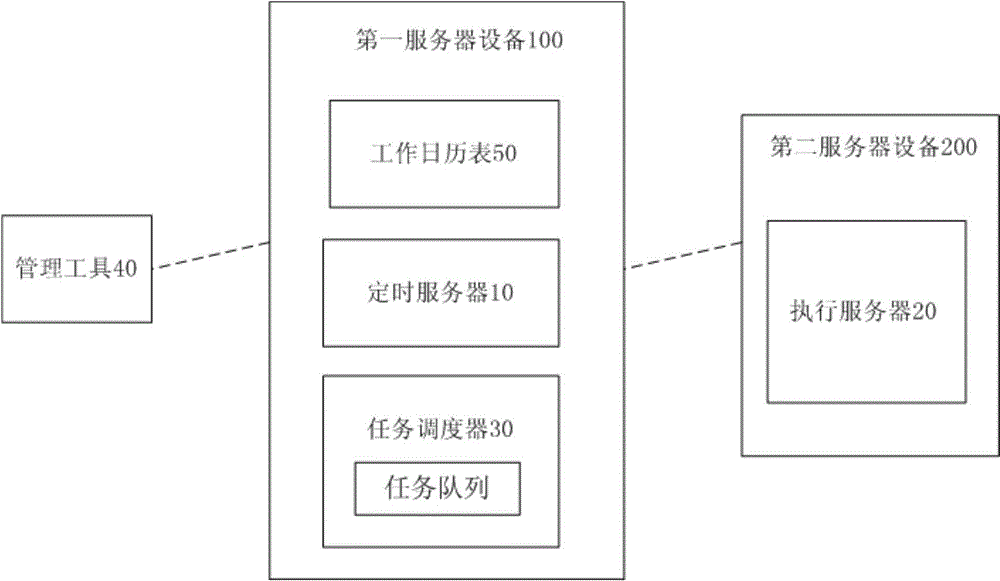

Timed task management system

InactiveCN104966177AUnderstand the purposeLearn about featuresResourcesTransmissionManagement toolServer appliance

Provided is a timed task management system. The system comprises a timed server, an execution server and the timed server and the execution server are respectively installed on a first server device and a second server device which are separated from each other physically. The system comprises a task scheduler, a work calendar and a management tool which are installed on the first server device. The work calendar identifies working days and holidays. The management tool executes definition of a task and controls on and off of the timed server. The timed server determines a task content and task execution time according to the work calendar and according to the definition of the task by the management tool. The task scheduler keeps a task queue to be executed, starts tasks in the set time according to the task queue, and provides an instant task starting signal for the execution server. The task scheduler receives the task content and task execution time from the timed server, and compares the received task execution time with the task queue to insert the received task content into the queue. The execution server executes the task according to the instant task starting signal.

Owner:SHANGHAI FENZHONG SOFTWARE TECH

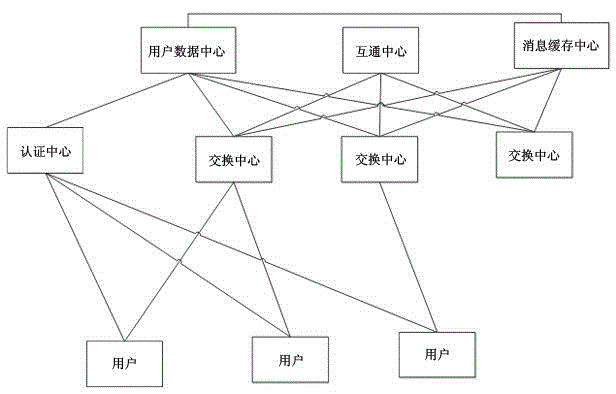

Method for implementing daily work reports in enterprise mobile office system

InactiveCN104573920AEasy to carry outEasy task assignmentOffice automationResourcesBusiness enterpriseKnowledge management

The invention discloses a method for implementing daily work reports in an enterprise mobile office system. The method comprises the following steps: establishing the enterprise mobile office system which comprises a user data center, an interworking center, a caching center, an authentication center and at least one exchange center; implementing the daily work reports which comprises reporting the daily work reports to a superior by employees, reminding work reports required to be edited and sent on time and sending a statistic reminding message to the superior, and reminding the employees to edit the work reports and reminding the superior of the employees who do not complete the work reports. According to the method, the work reports of all the subordinate employees can be directly checked, so that a reliable basis is provided for integral scheduling and macroscopic control of an company; the daily work reports of the employees can be checked only by the superior or concerned members, so that privacy of the employees is guaranteed; daily work report reminders can be sent to the employees who do not report temporarily at a specified time every day, and a superior leader can be reminded of the employees who do not complete the work reports, so that a work idea that daily work is completed on the right day and not delayed to tomorrow is forcibly indoctrinized.

Owner:SICHUAN UCS COMM TECH

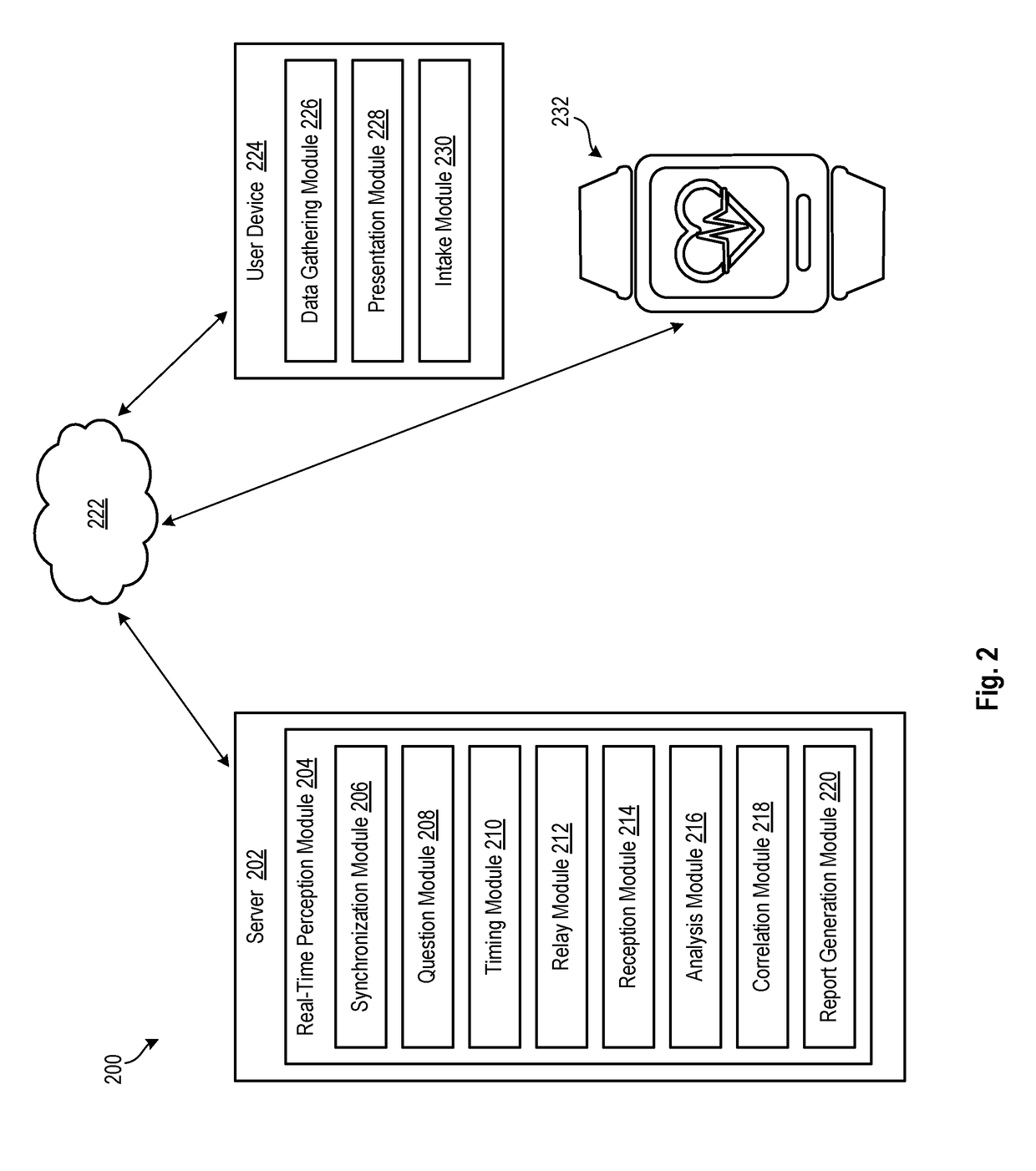

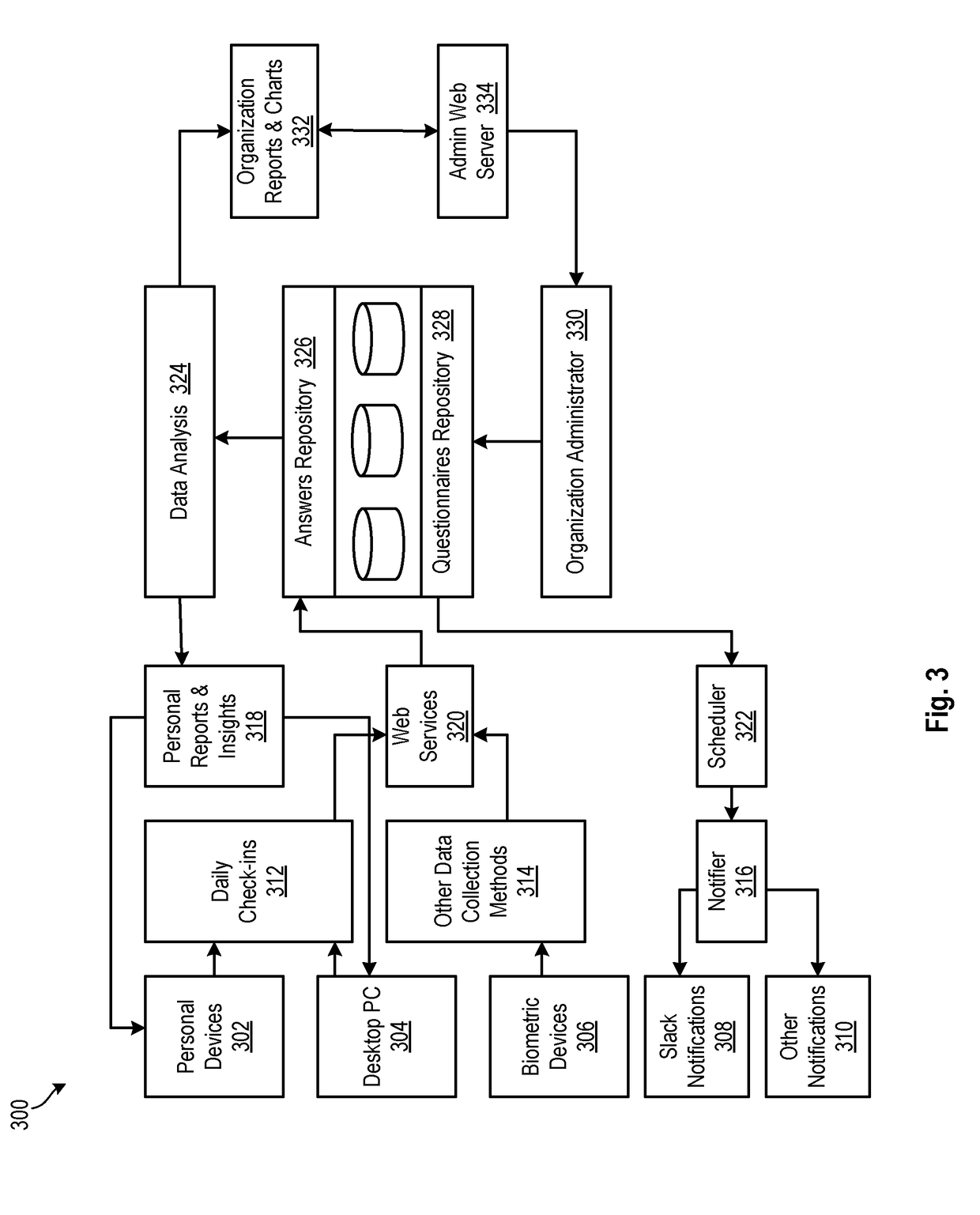

System And Method For Assessing Worker Engagement And Company Culture

A method for assessing worker engagement and company culture. The method includes generating questions relating to a user's work experience, determining a set of predetermined times during the user's workday to prompt the user to answer the questions, and prompting the user at each of the predetermined times to provide an answer, in real time, to each of the questions. Answers may be received from the user and then correlated with contextual data associated with the user. A corresponding system and computer program product are also disclosed and claimed herein.

Owner:WORKRIZE PBC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com