Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

895 results about "Transaction processing system" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Transaction processing is a way of computing that divides work into individual, indivisible operations, called transactions. A transaction processing system (TPS) is a software system, or software/hardware combination, that supports transaction processing.

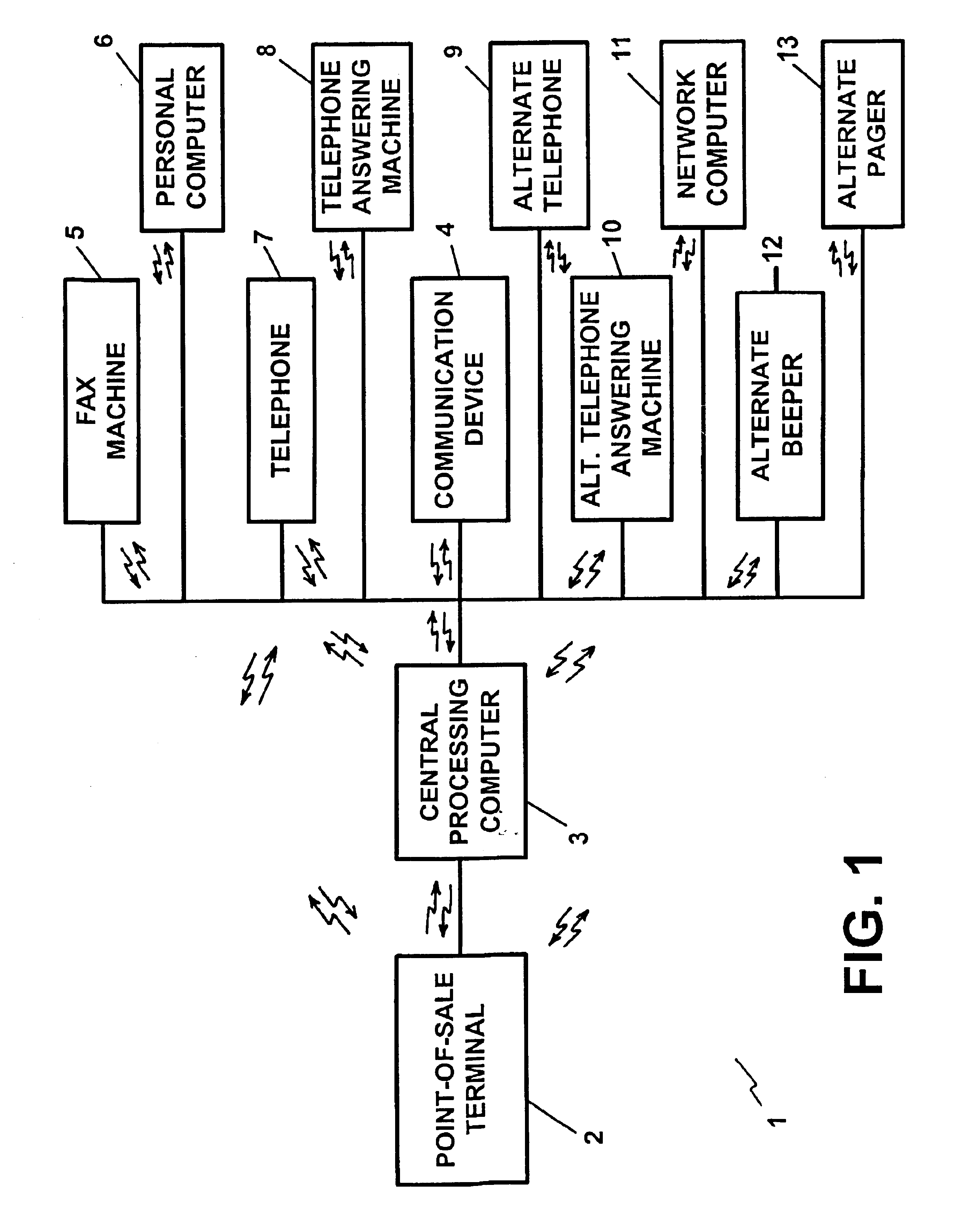

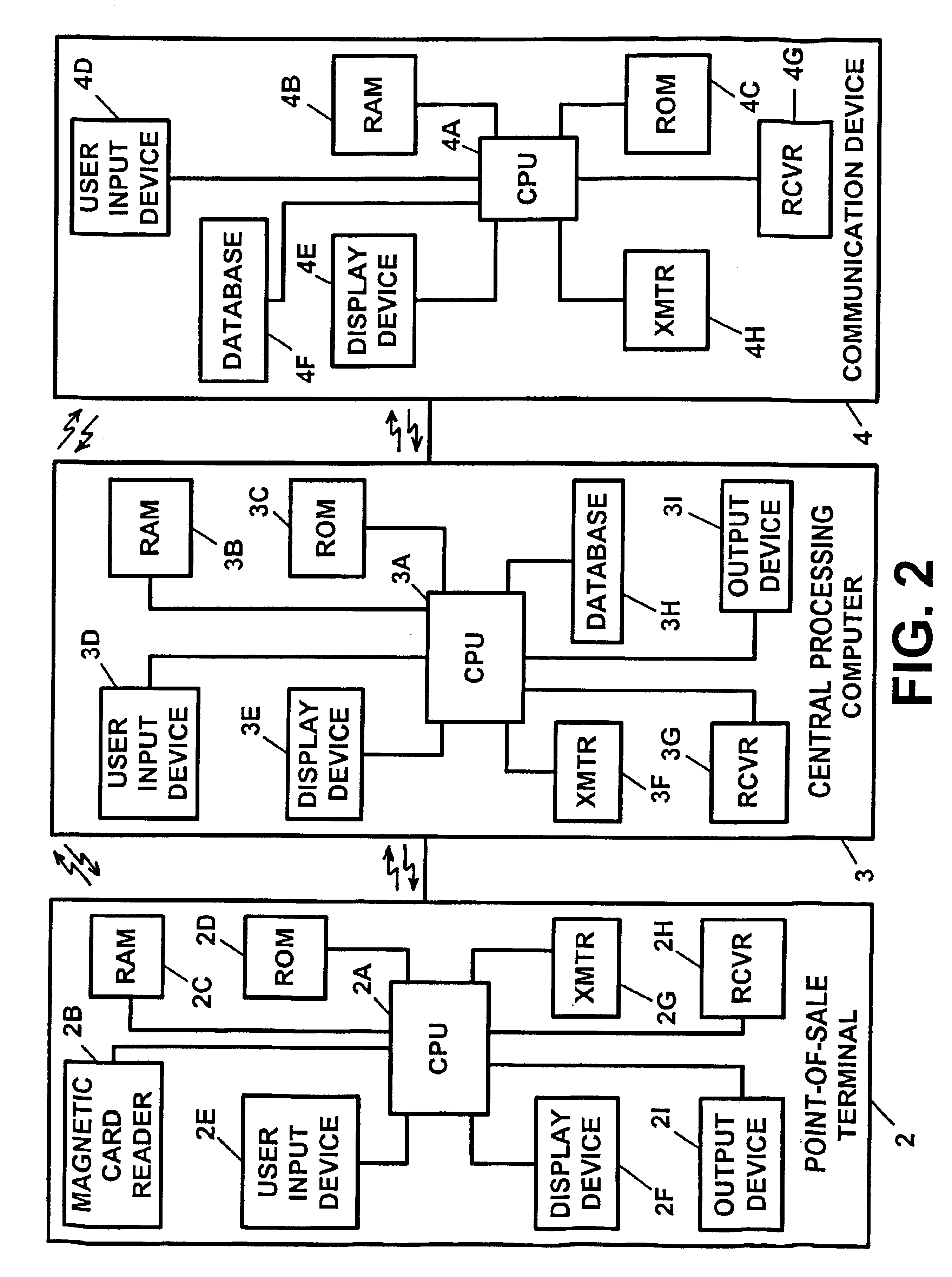

System and method for processing financial transactions

InactiveUS7571139B1Improve securityGreat degree of convenienceFinanceCash registersPaymentFinancial transaction

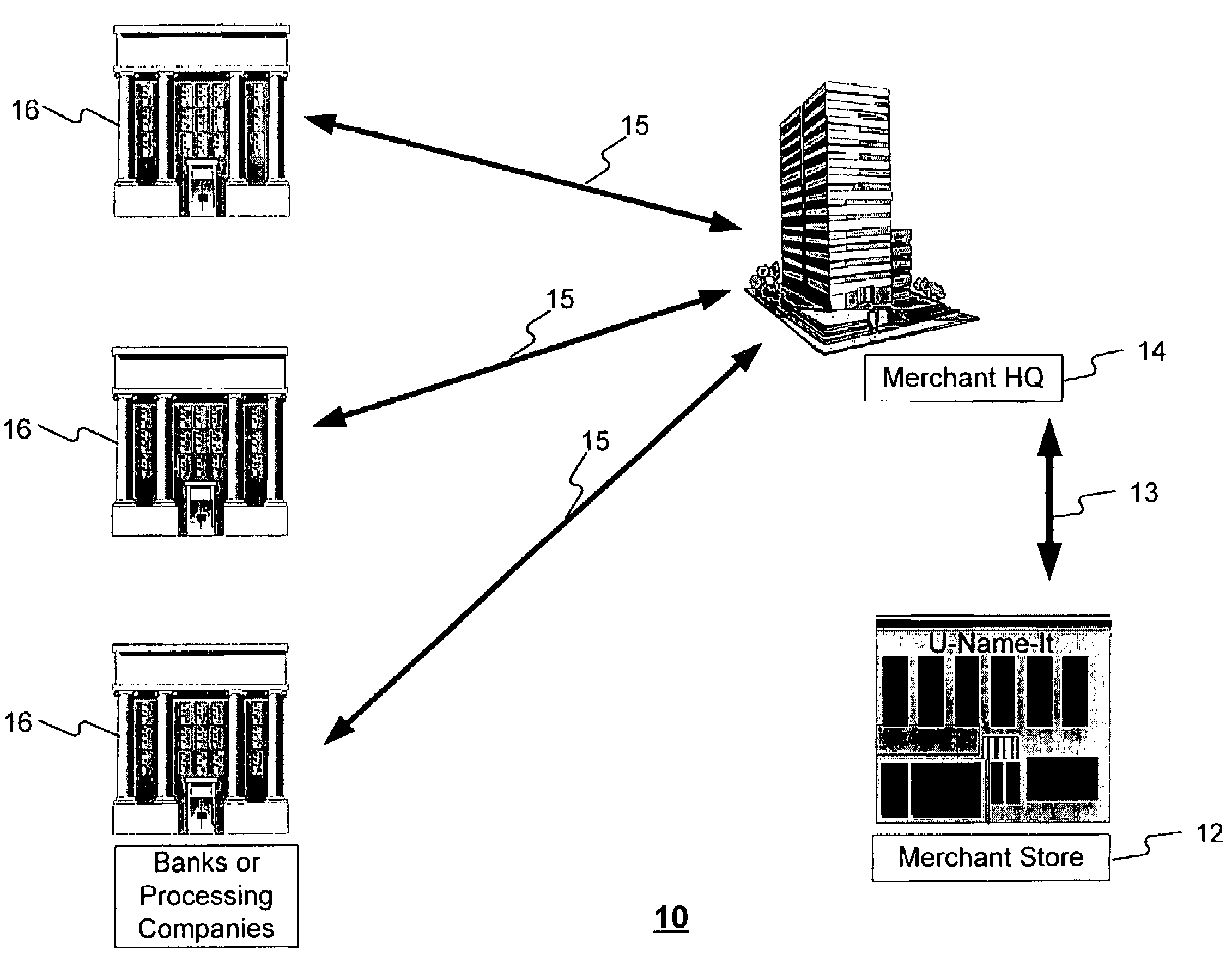

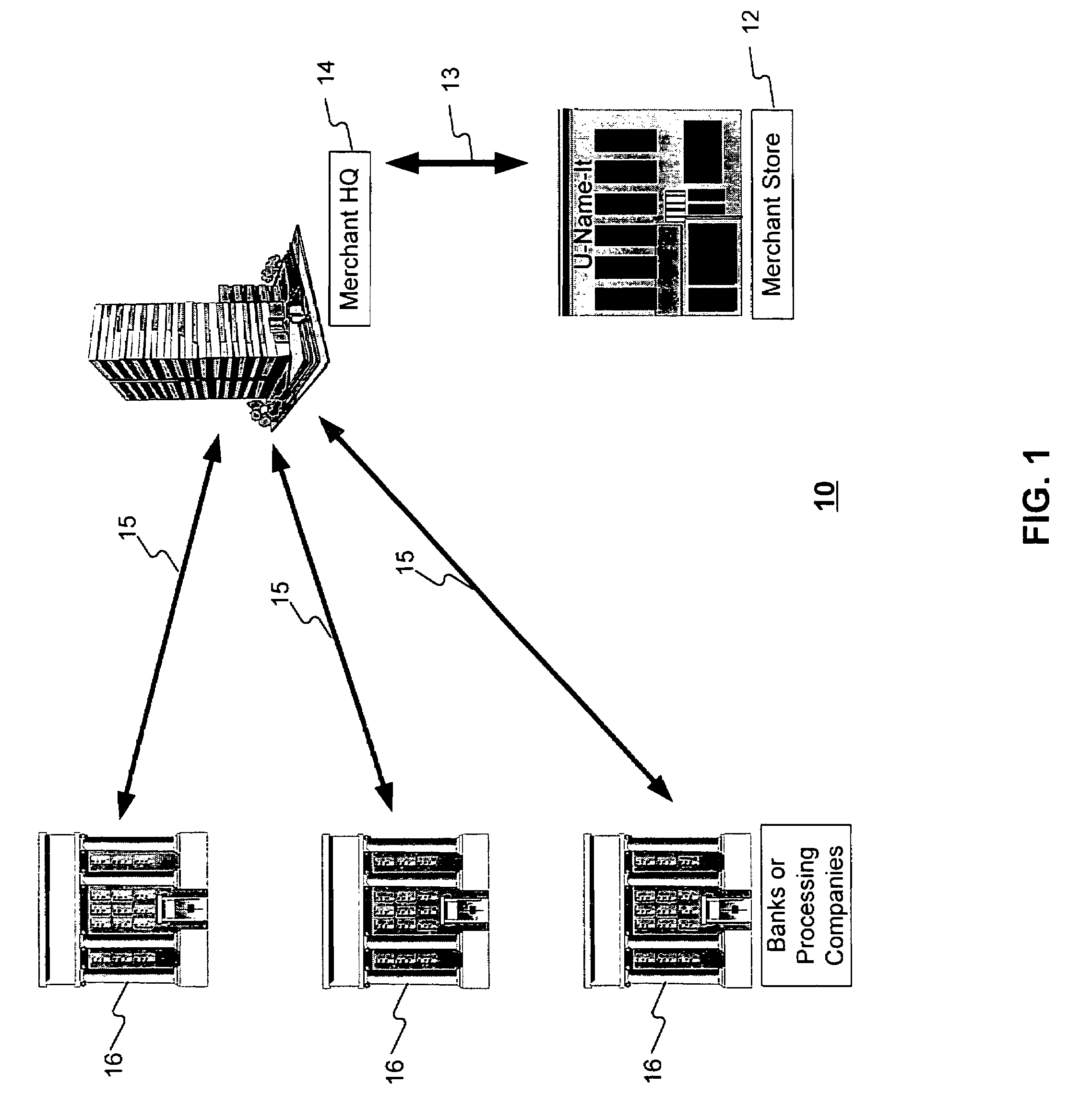

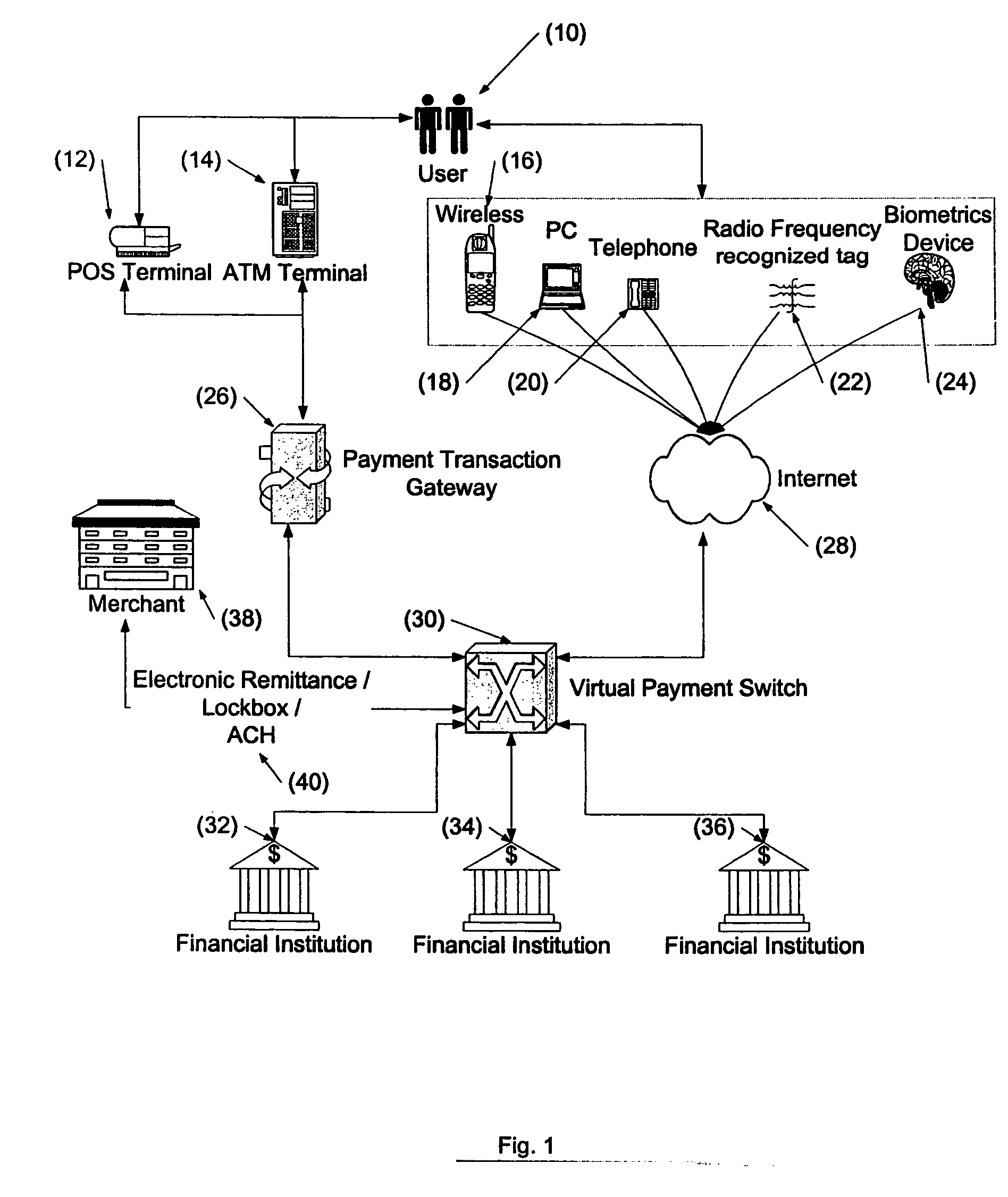

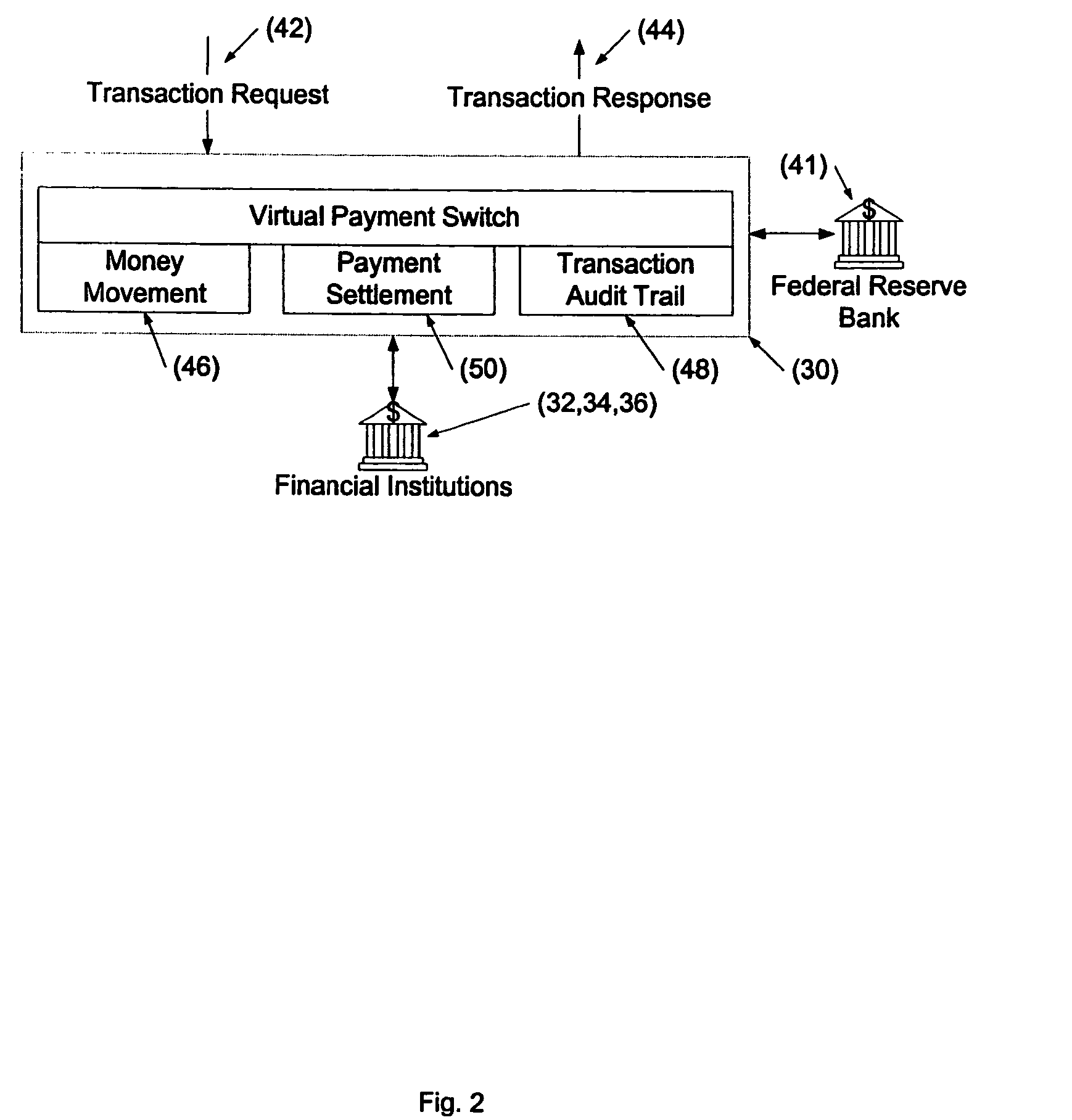

A network for processing retail sales transactions includes a customer transceiver with a unique customer number, a reader receiving the customer number and sending it to a point-of-sale device where it is combined with transaction information to form a transaction entry. The transaction entry is sent through a merchant computer to a transaction processing system having a customer database. The transaction processing system references an entry in the customer database corresponding to the customer / transmitter ID number and routes the transaction entry to a payment processing system specified in the customer database entry.

Owner:EXXON RES & ENG CO +1

Transaction security apparatus

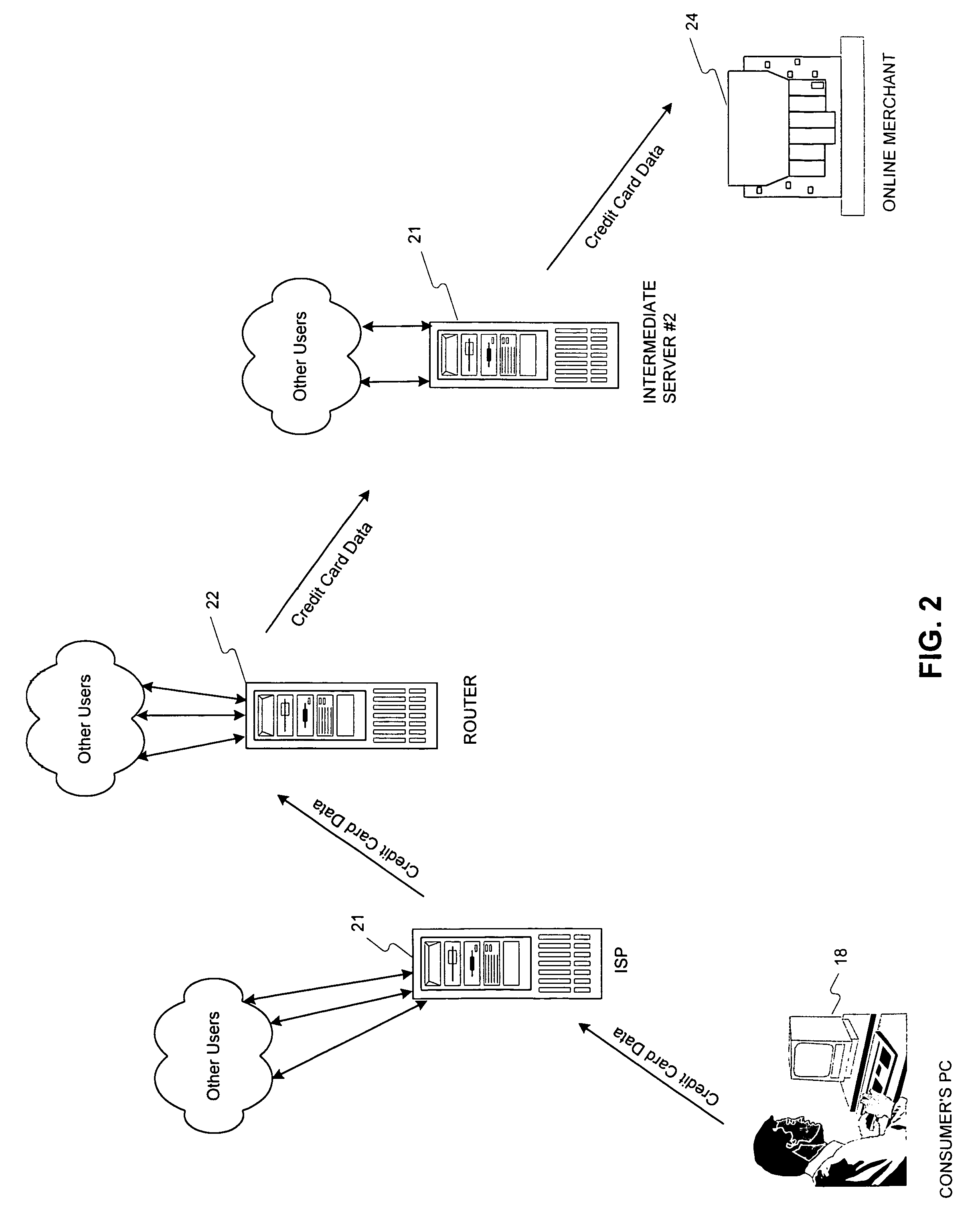

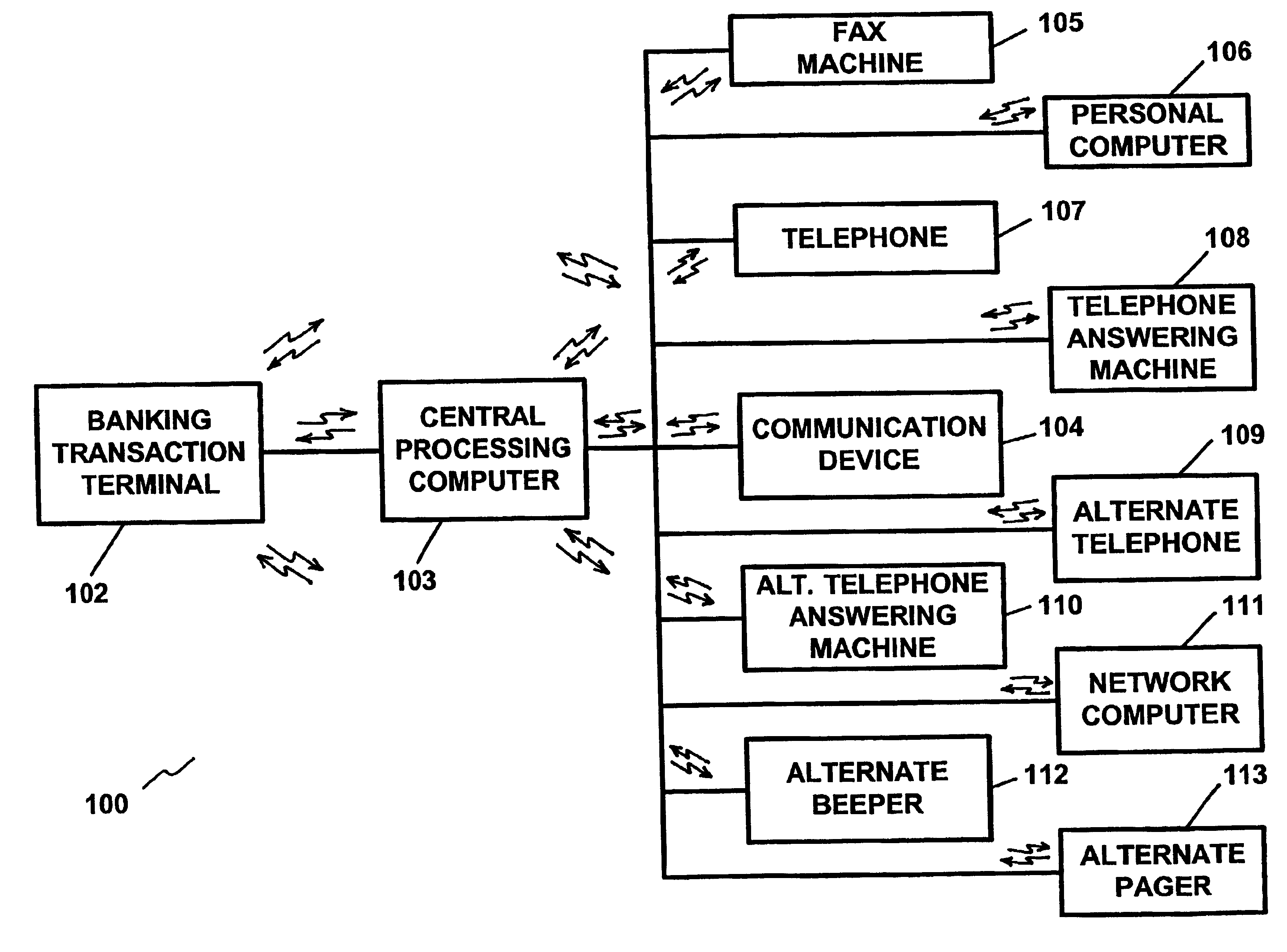

InactiveUS7096003B2Real time monitoringDigital data processing detailsPayment architectureThe InternetTransaction processing system

An apparatus including a memory device for storing a limitation or restriction on an account use received via the Internet and / or World Wide Web and a processing device for determining whether a transaction on the account or a use of a wireless or cellular communication device is authorized, allowed, or disallowed. An apparatus including a processing device for processing information regarding a banking transaction or use of a wireless or cellular communication device and generating a signal containing information regarding the transaction or device use and a transmitter for transmitting the signal to a communication device. An apparatus including a processing device for processing transaction information and generating a signal containing transaction information, and a transmitter for transmitting the signal to a communication device via the Internet and / or World Wide Web independently of transaction processing by a central transaction processing computer.

Owner:JOAO BOCK TRANSACTION SYST

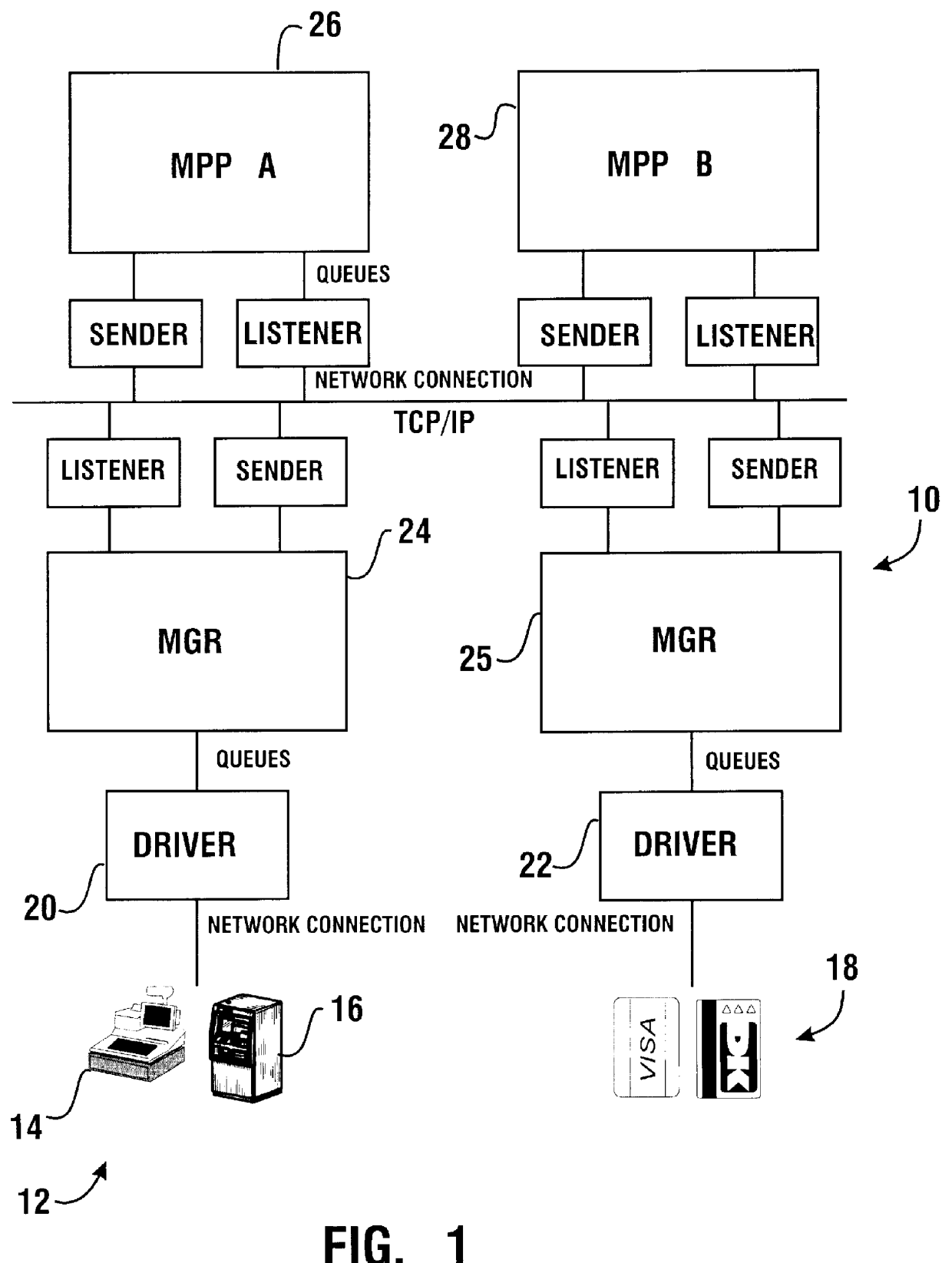

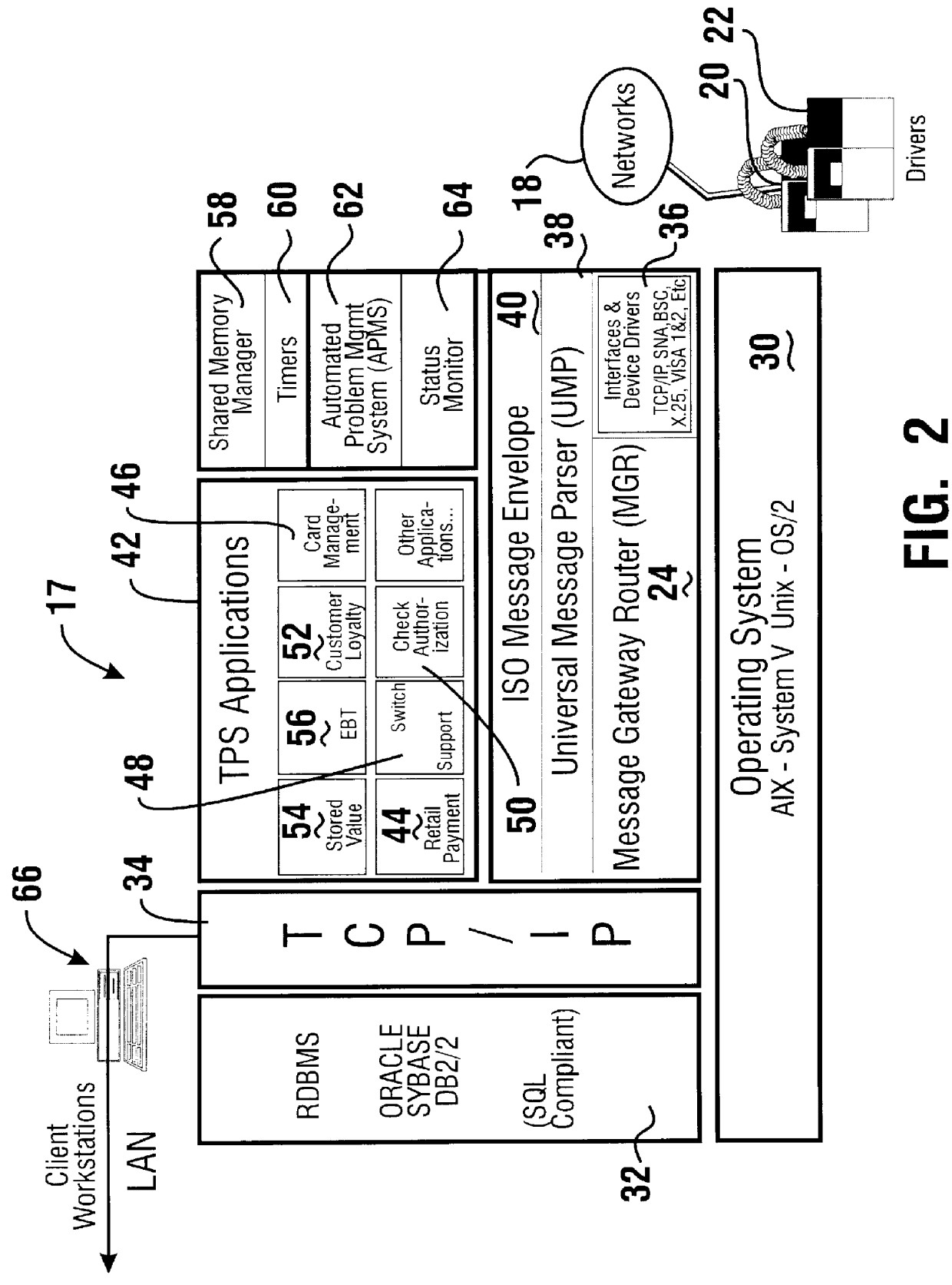

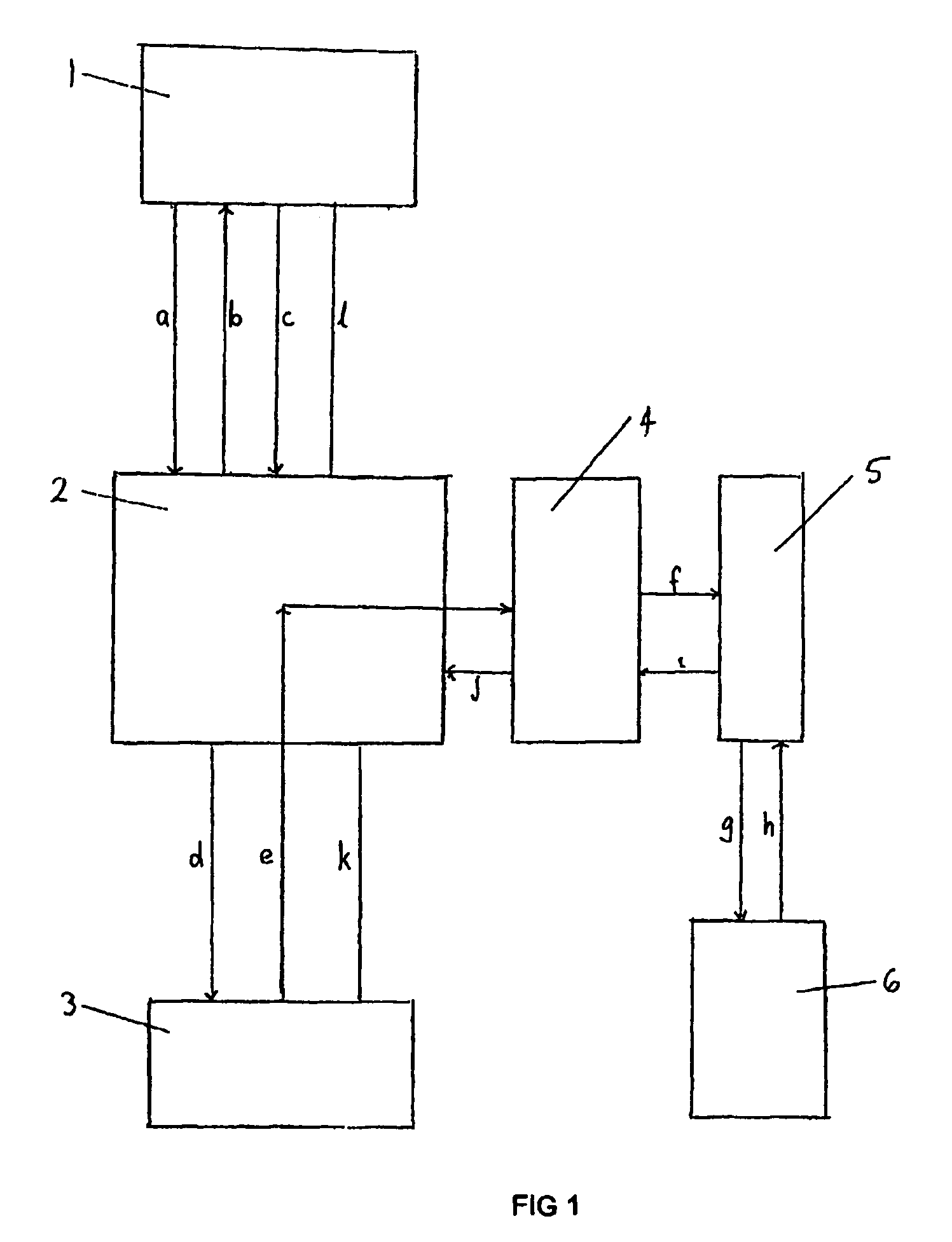

Financial transaction processing system and method

InactiveUS6039245AEasy to develop and modifyEasy to changeComplete banking machinesHand manipulated computer devicesRelational databaseTerminal equipment

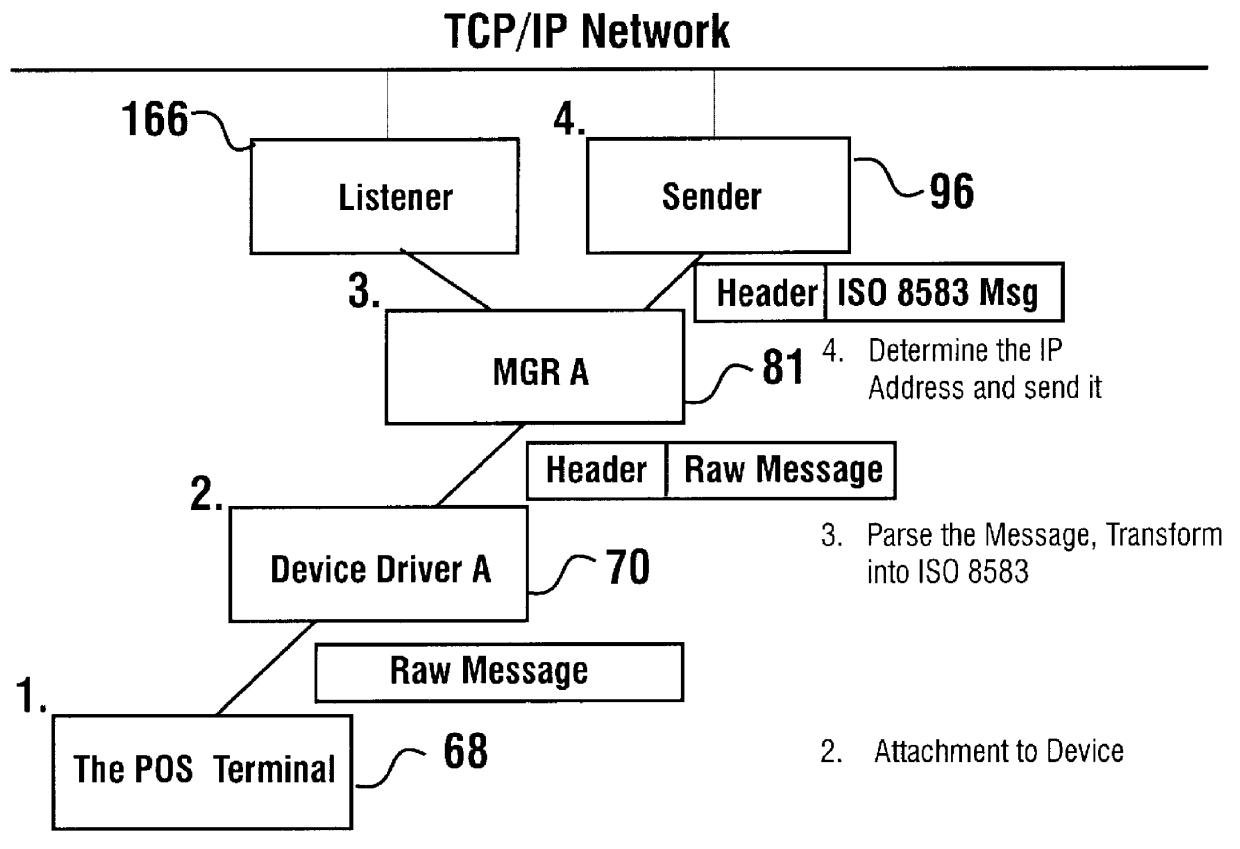

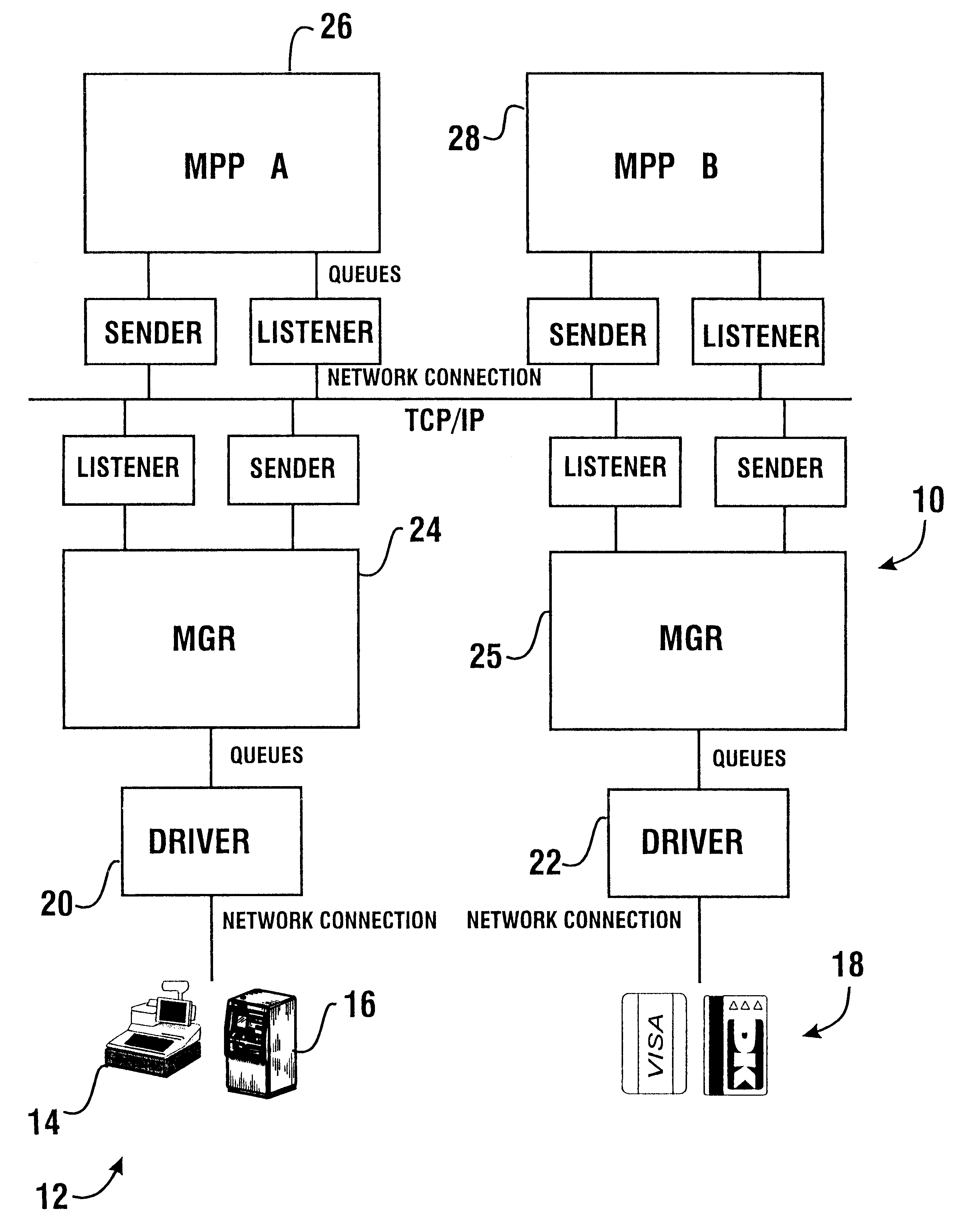

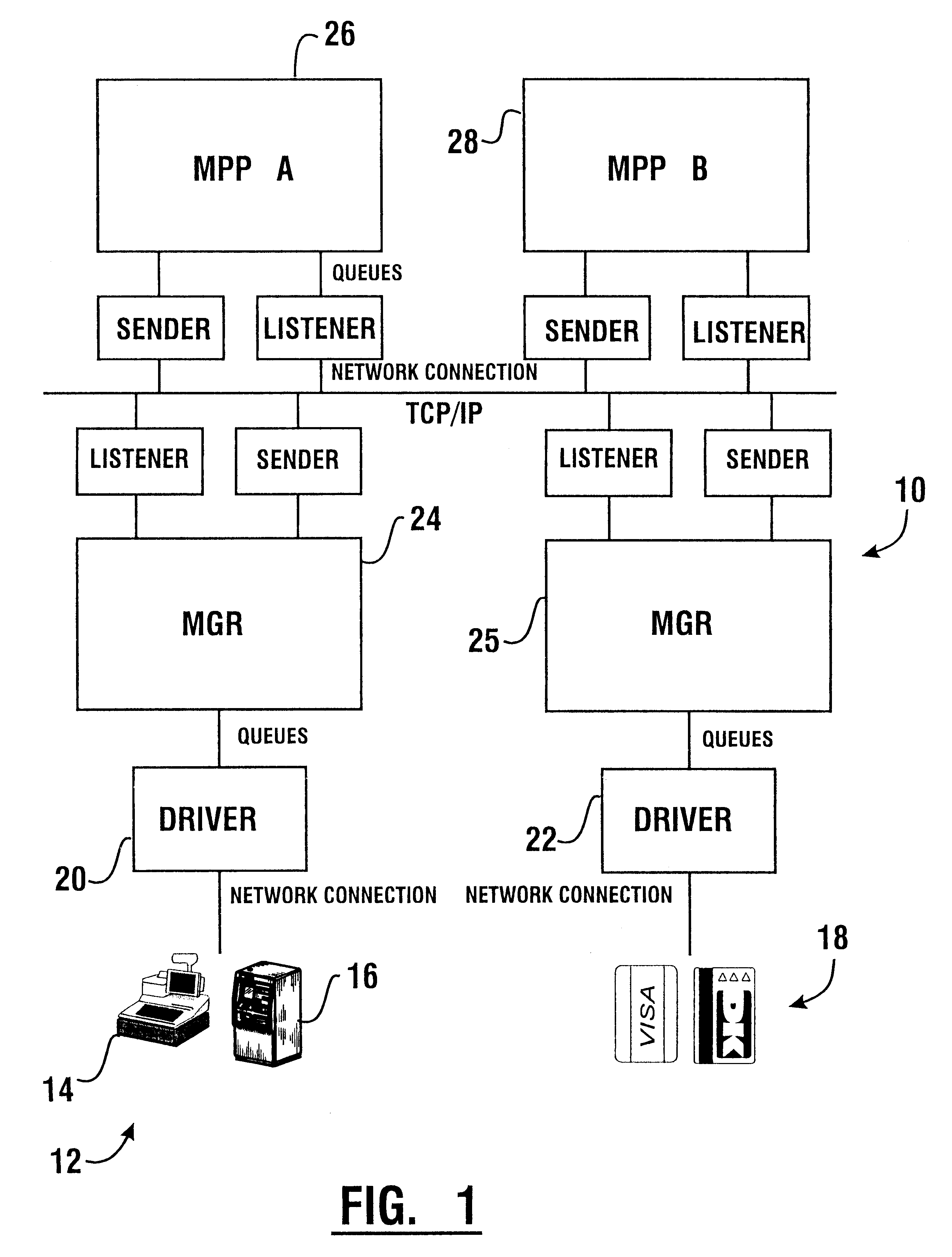

A financial transaction processing system (10) enables processing transactions from various types of card activated terminal devices (12) which communicate using a variety of electronic message formats. The transaction processing system may operate to authorize transactions internally using information stored in a relational database (32) or may communicate with external authorization systems (18). The transaction processing system includes among its software components message gateway routers (MGRs) (24, 164) which operate using information stored in the relational database to convert messages from a variety of external message formats used by the external devices and authorization systems, to a common internal message format used within the system. The system further uses database information to internally route messages to message processing programs (MPPs) (108, 138) which process messages and generate messages to the external devices and authorization systems. The MGR also converts the outgoing messages from the internal message format to the external message formats which can be interpreted by the external devices and systems to which the messages are directed.

Owner:DIEBOLD NIXDORF

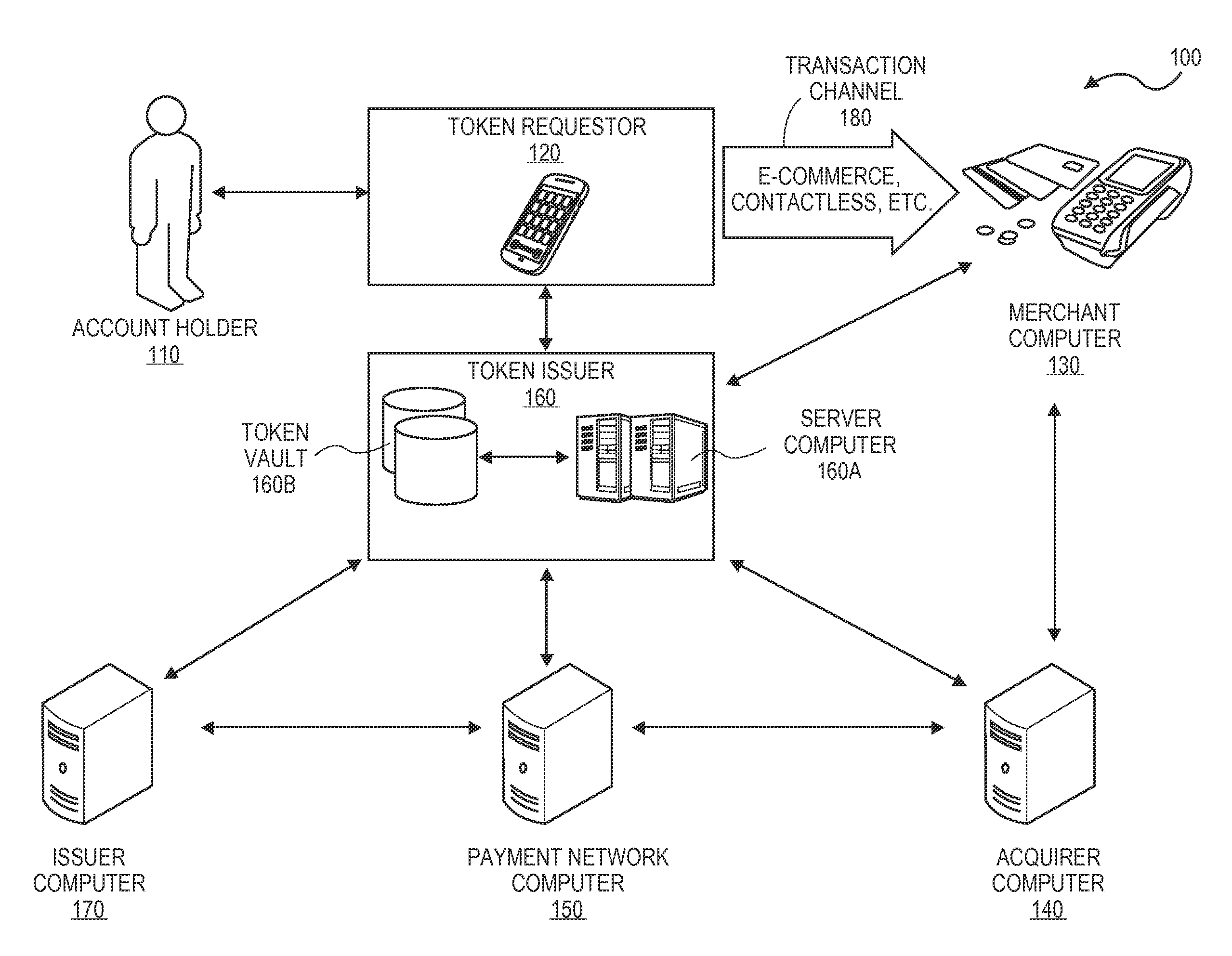

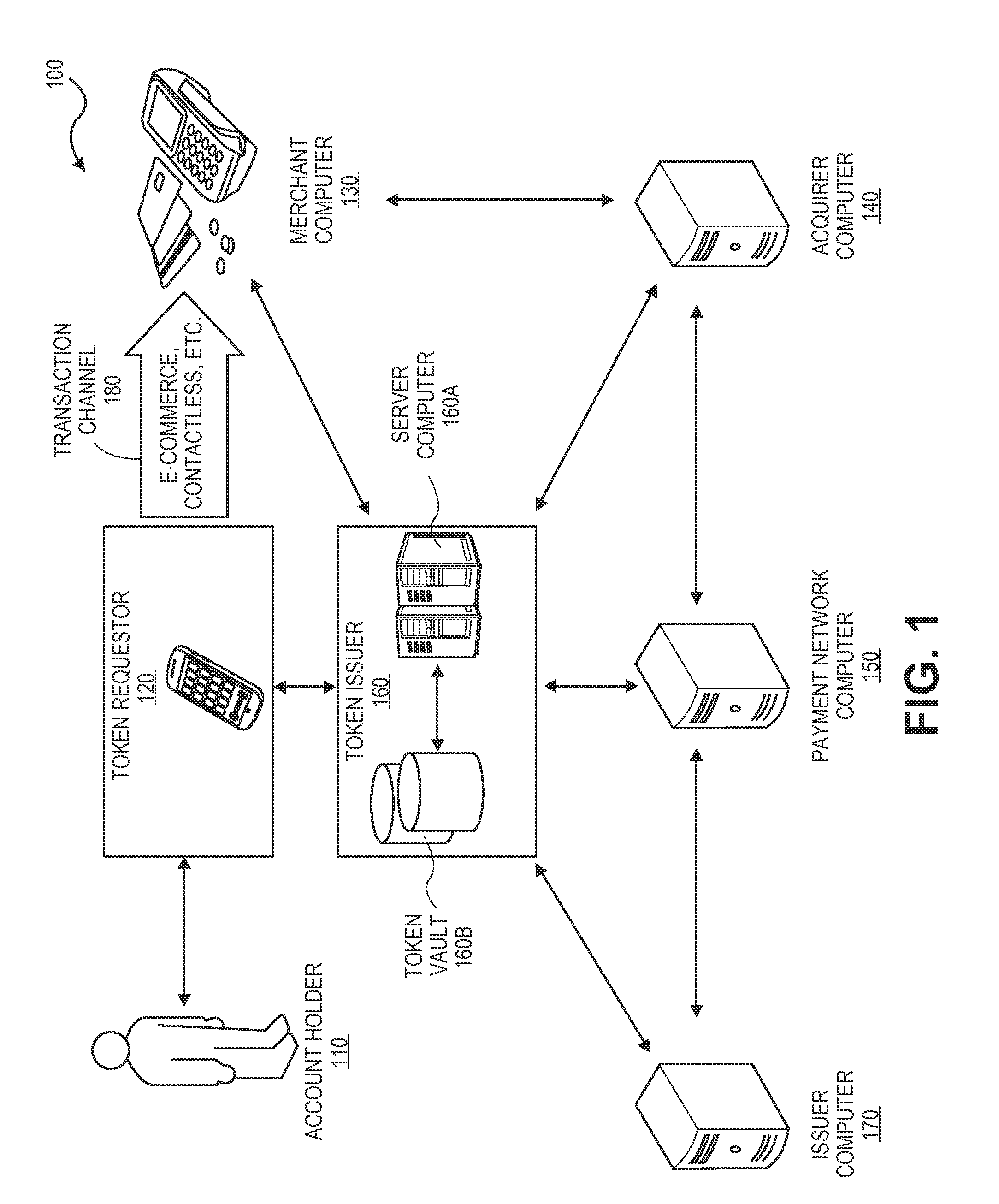

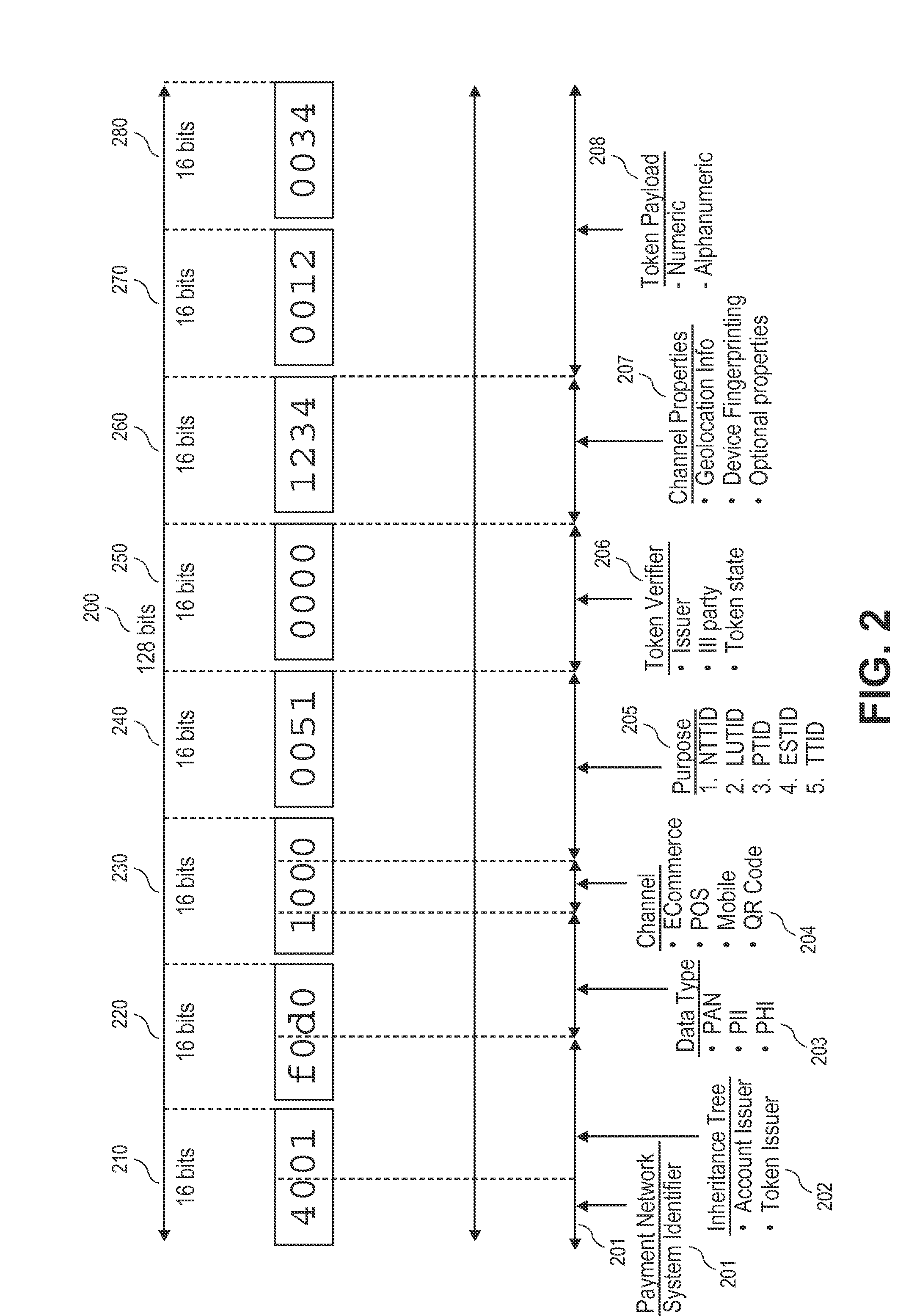

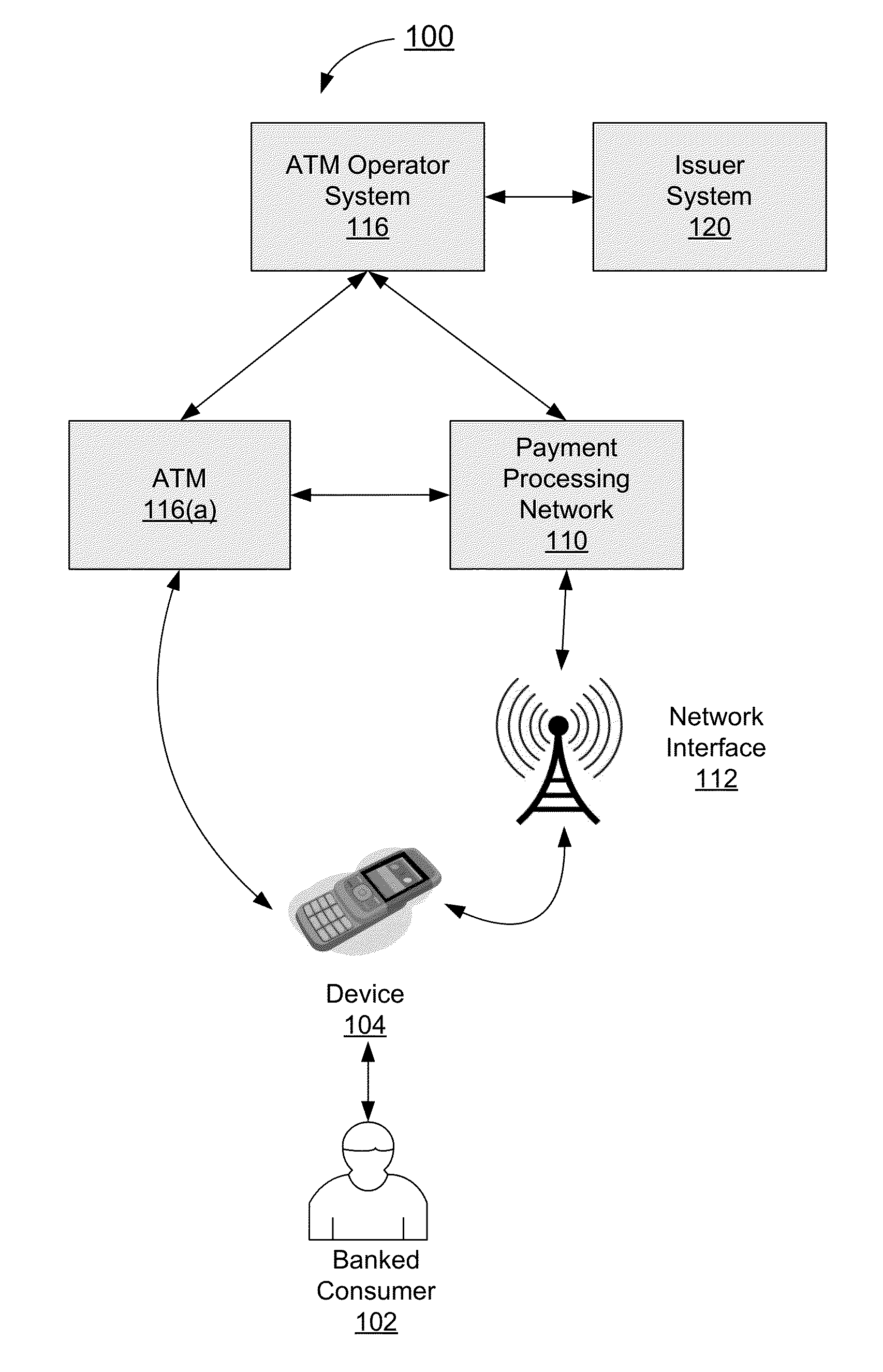

Contextual transaction token methods and systems

ActiveUS20150112870A1Electronic credentialsProtocol authorisationMachine learningTransaction processing system

Embodiments of the present invention are directed to methods, systems, apparatuses, and computer-readable mediums for generating and providing a transaction token that may provide contextual information associated with the token. Accordingly, the transaction token may provide any entities within a transaction processing system immediate information about the context in which the token was generated, how the token may be used, and any other information that may be pertinent to processing the token.

Owner:VISA INT SERVICE ASSOC

Authentication process for value transfer machine

InactiveUS20130226799A1Prolong transaction processComplete banking machinesFinanceComputer hardwareMessage authentication code

Embodiments of the invention are directed towards improved transaction processing methods and systems with transaction apparatuses, including a value transfer machine, using a device identifier instead of a value transfer machine card to process a transaction. One embodiment of the transaction may be directed to a transaction apparatus and a method including receiving an authentication code from a consumer, sending the authentication code to a first server computer, wherein if the received authentication code matches a generated authentication code, the first server sends a confirmation message. The method continues by receiving the confirmation message from the first server, receiving a secret token from the consumer, and sending an authorization request message to a second server computer. Thereafter, the transaction apparatus receives an authorization response message from the second server, indicating whether the secret token matches an expected token. Other embodiments are directed to first and second servers and corresponding methods.

Owner:VISA INT SERVICE ASSOC

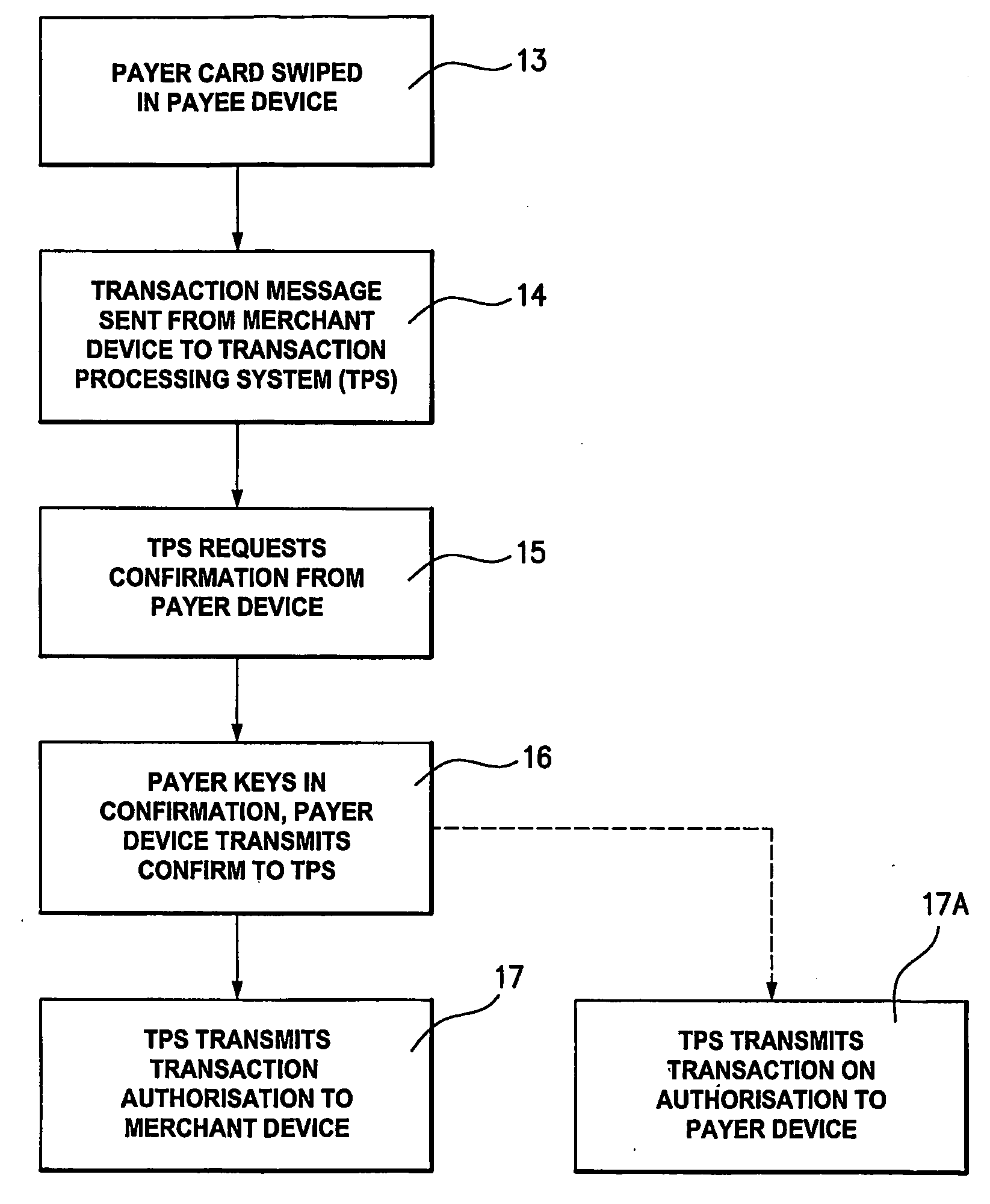

Transaction Processing Method, Apparatus and System

InactiveUS20090099961A1Takes burdenImprove securityComplete banking machinesFinanceIssuing bankPayment transaction

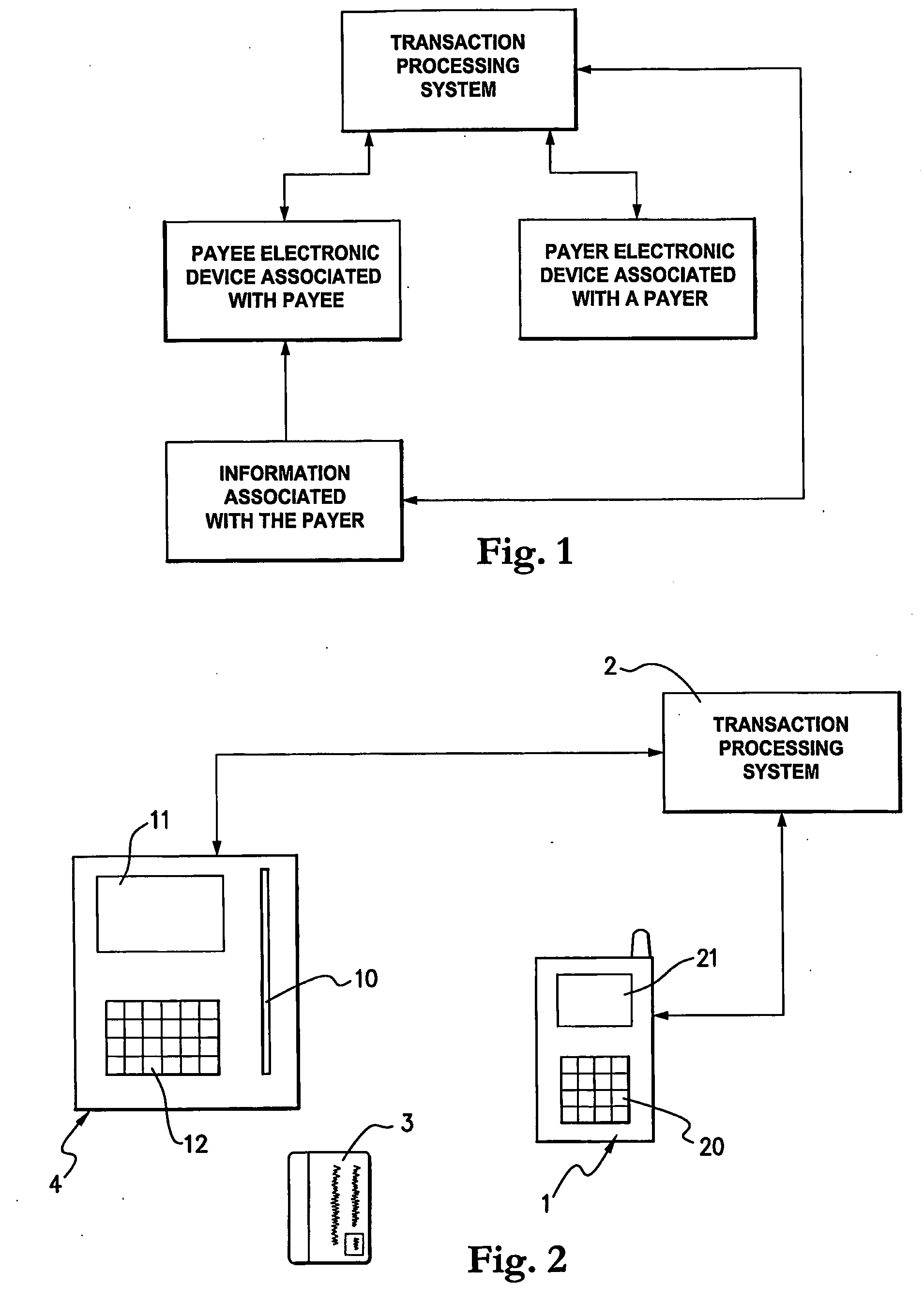

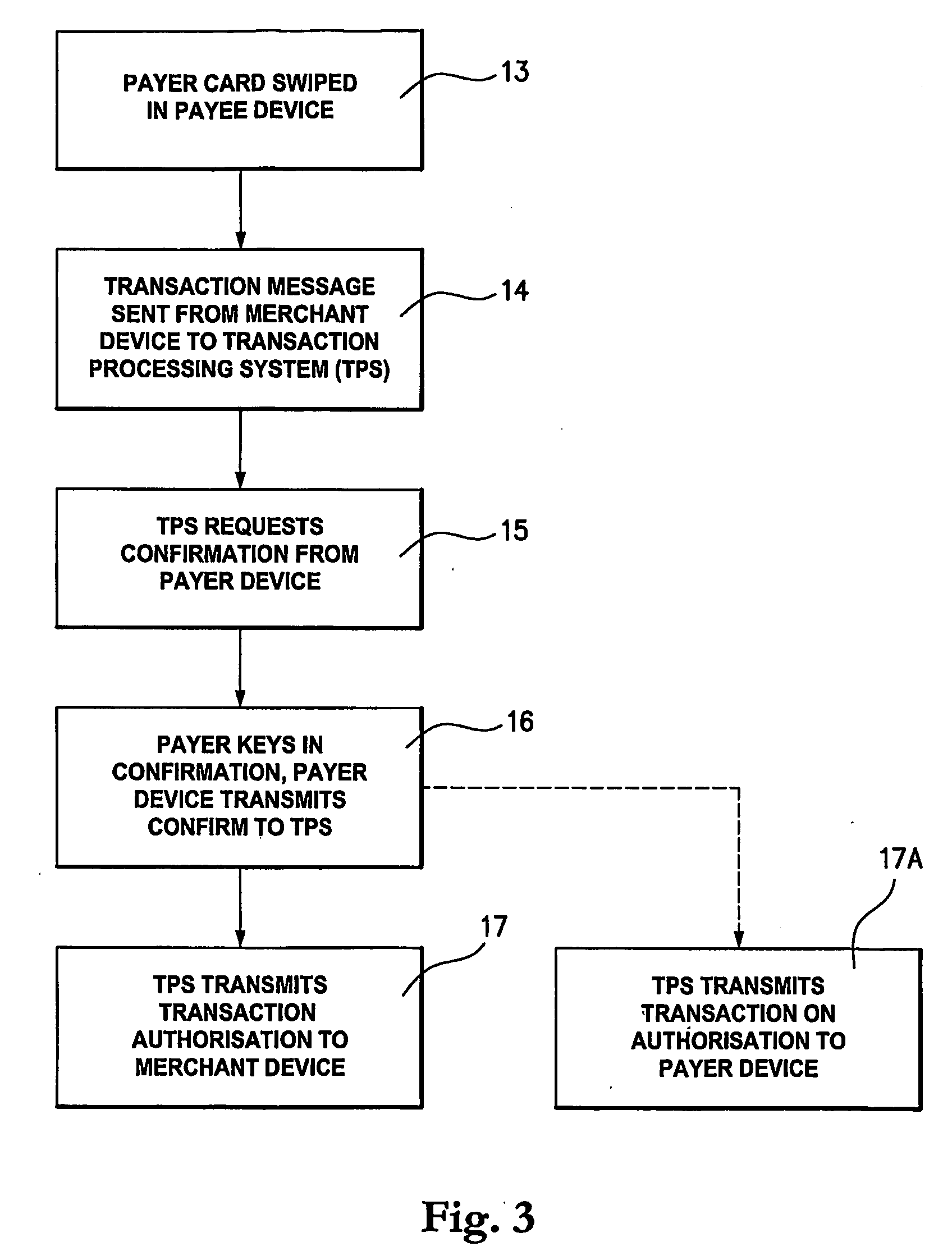

The present invention relates to transaction processing, for processing of payments between payer's (usually individual payers) and payee's (usually merchants. Conventionally, a payment transaction involves a user's account details being provided to a merchant device, e.g. by swiping a card in the card swipe of the merchant device. The merchant device then prepares a transaction message including information such as the user's account ID, merchant ID and payment information and forwards that message to a transaction processing system, which may comprise a transaction acquirer and an issuing bank. The transaction processing system approves the payment and returns confirmation to the merchant. In the present invention a device associated with the payer, which in a preferred embodiment is a suitably adapted mobile telephone, becomes involved in the payment transaction process. At one level, the transaction processing system requests from the payer electronic device confirmation that the transaction should proceed and the payer keys in an appropriate PIN to authorise the transaction. At another level, all the transaction processing information is provided from the payer electronic device to the transaction processing system and the transaction processing system or the payer electronic device then confirm that the transaction is authorised to the merchant device. This takes the burden of transaction processing off the merchant and also increases the security of the transaction as the payer is in control. In a further embodiment, the payer electronic device may also upload listings of products and select products at the same time as paying for them, the payee (merchant) being advised of the selected product.

Owner:OGILVY IAN CHARLES

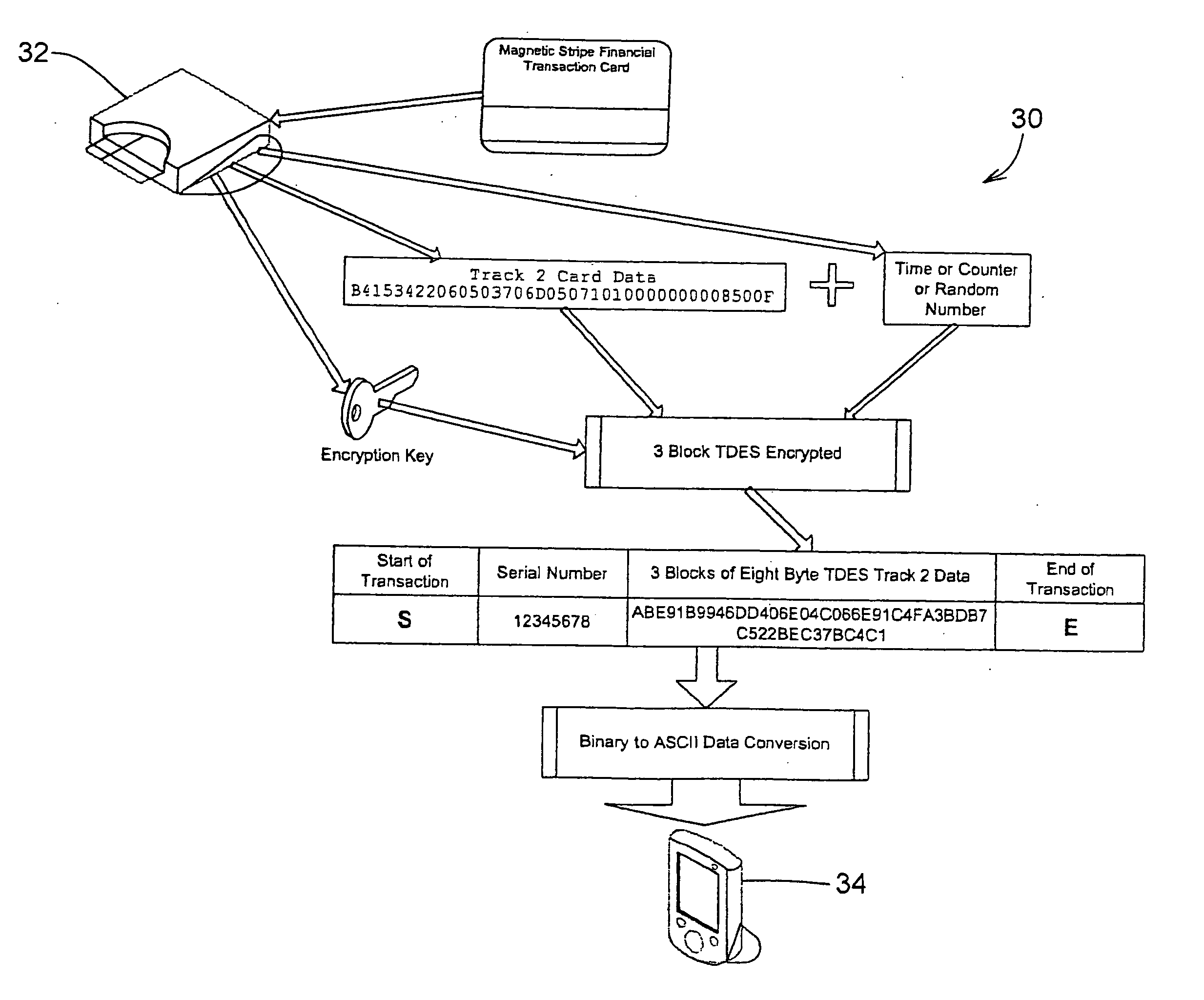

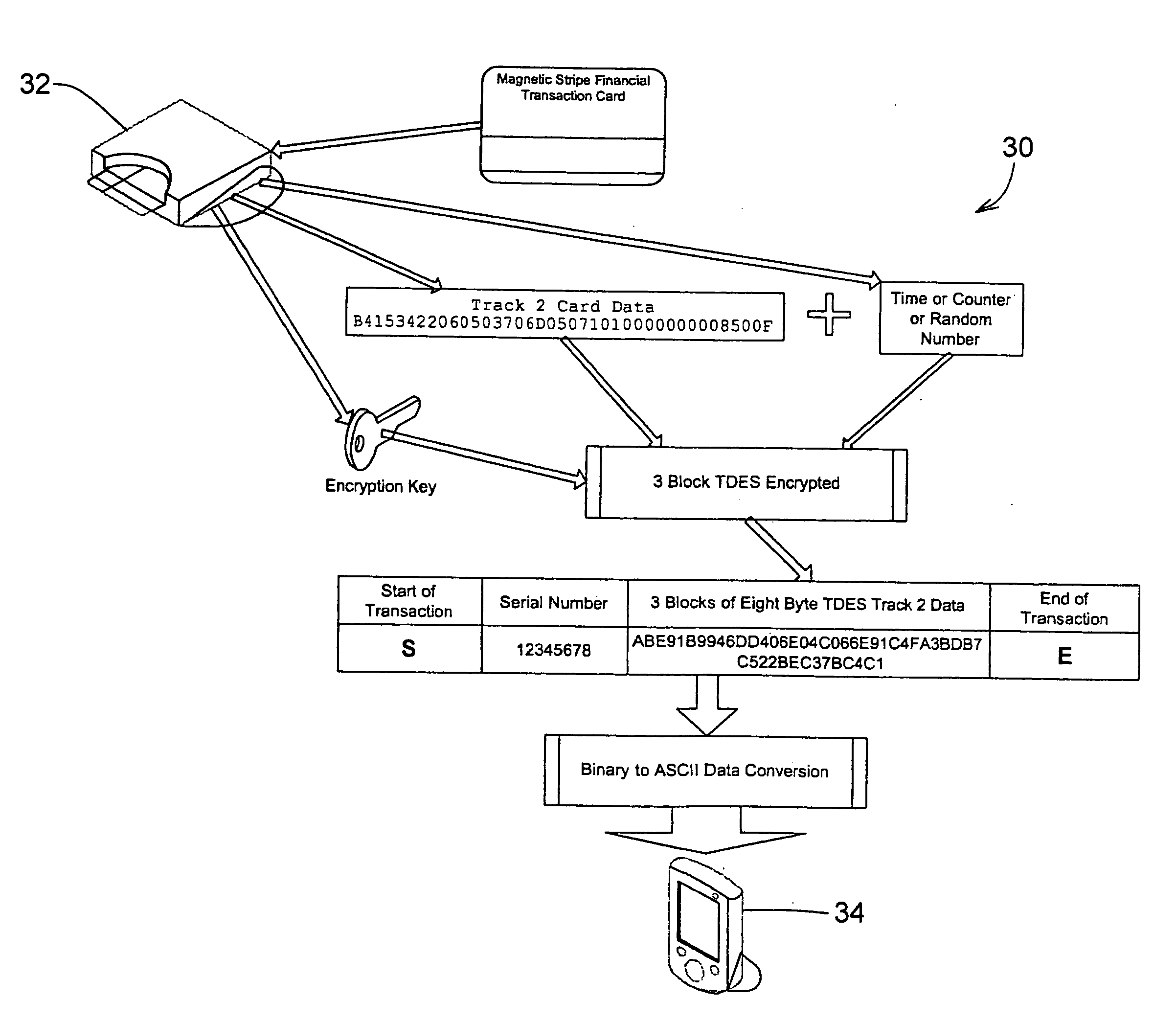

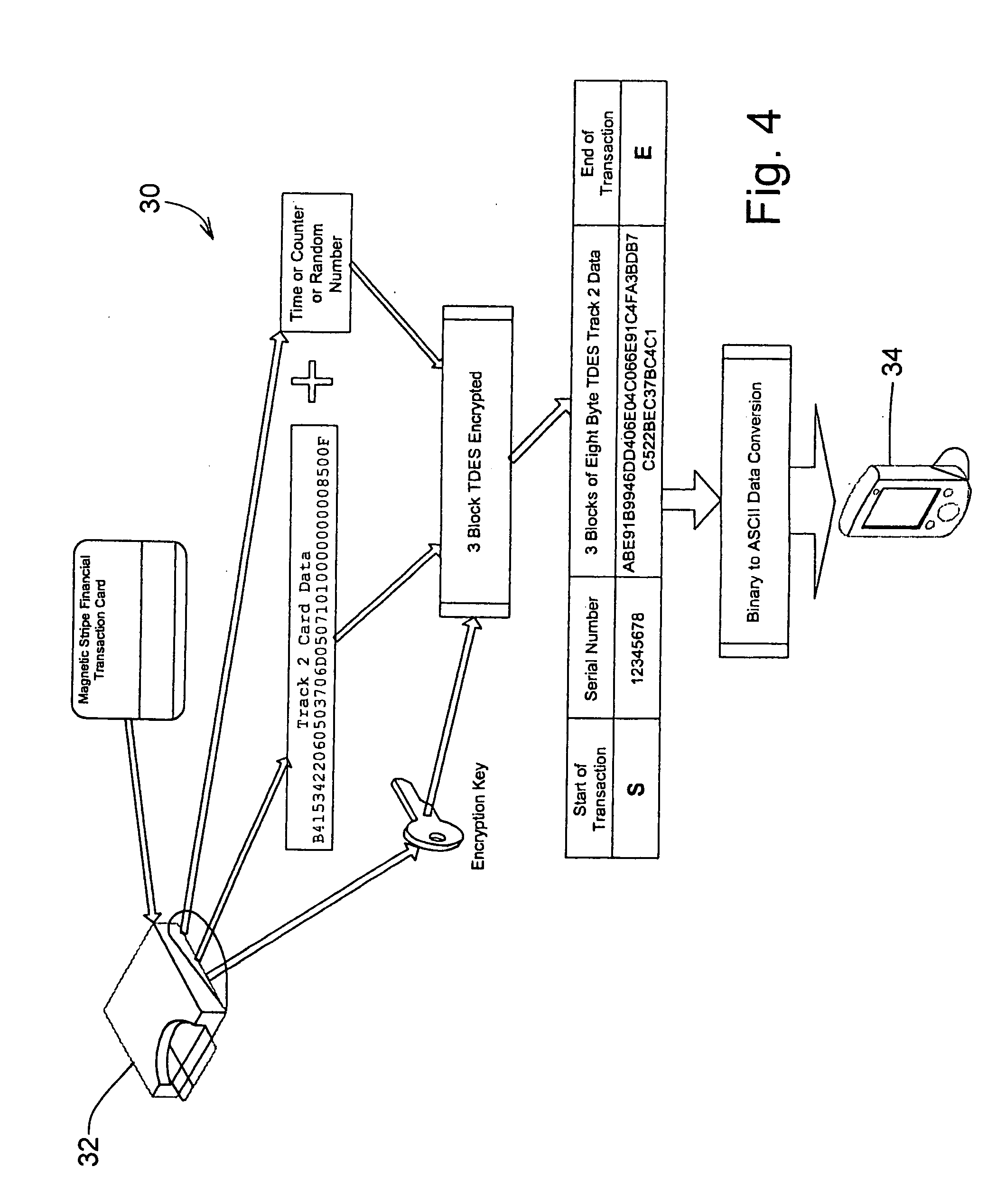

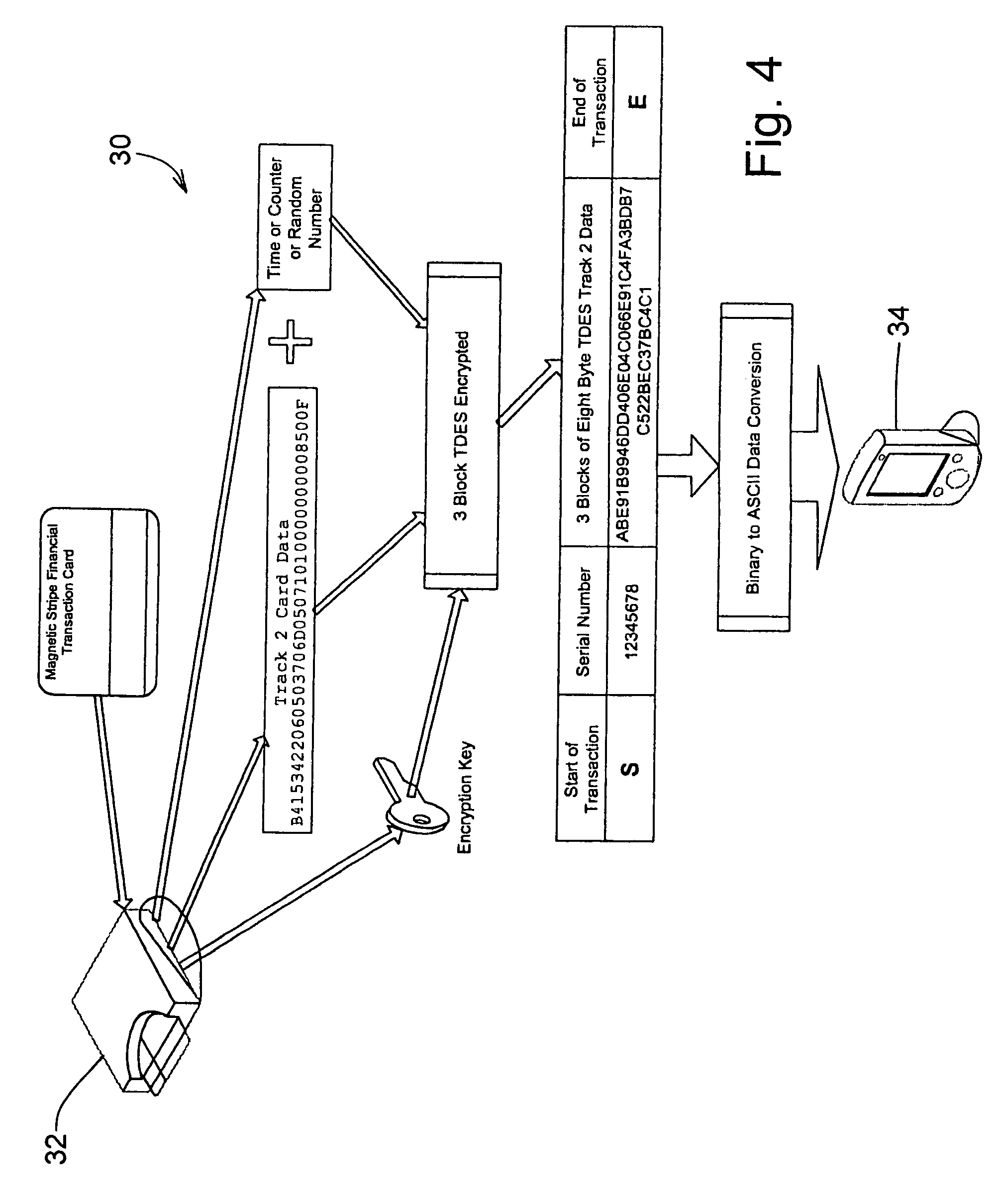

Transparently securing data for transmission on financial networks

ActiveUS20060049256A1Easy to operateIncrease powerAcutation objectsFinanceInformation processingSoftware system

A secure magnetic stripe card stripe reader (MSR) module and software system capable of encrypting the magnetic stripe data to CPI, SDP and CISP standards for use in point of sale (POS) and other applications requiring data security using non secure networks and computing devices. Additionally, when incorporated within an attachment for conventional personal digital assistant (PDA) or cell phone or stationary terminal, provides encrypted data from the magnetic head assembly providing compliance with Federal Information Processing Standards Publication Series FIPS 140 covering security and tampering standards. Moreover, this module and software system includes the capability of providing secure POS transactions to legacy transaction processing systems and POS terminals transparently to the existing infrastructure. Furthermore, this module and software system includes the capability of transparently providing detection of fraudulently copied magnetic stripe cards.

Owner:VERIFONE INC

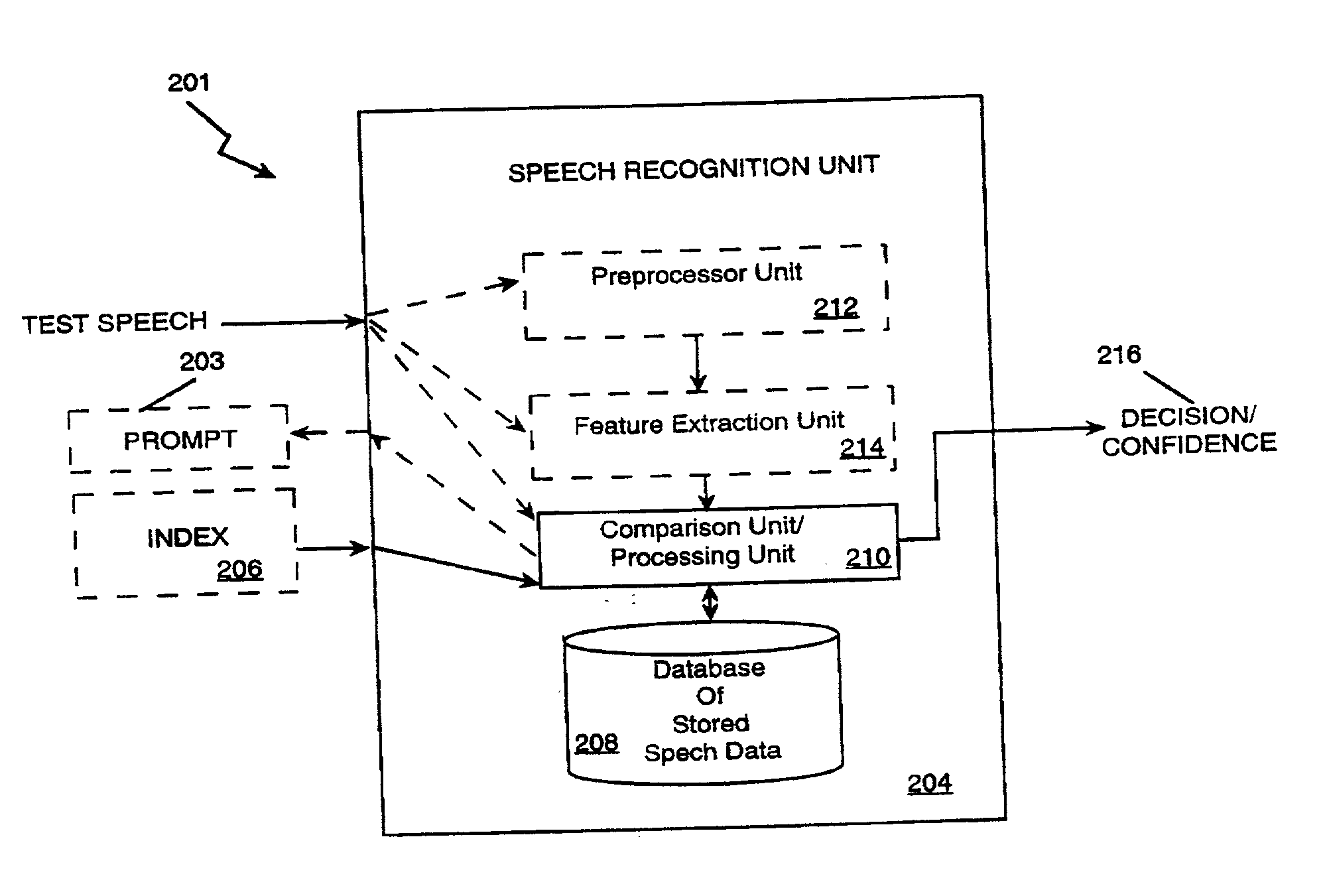

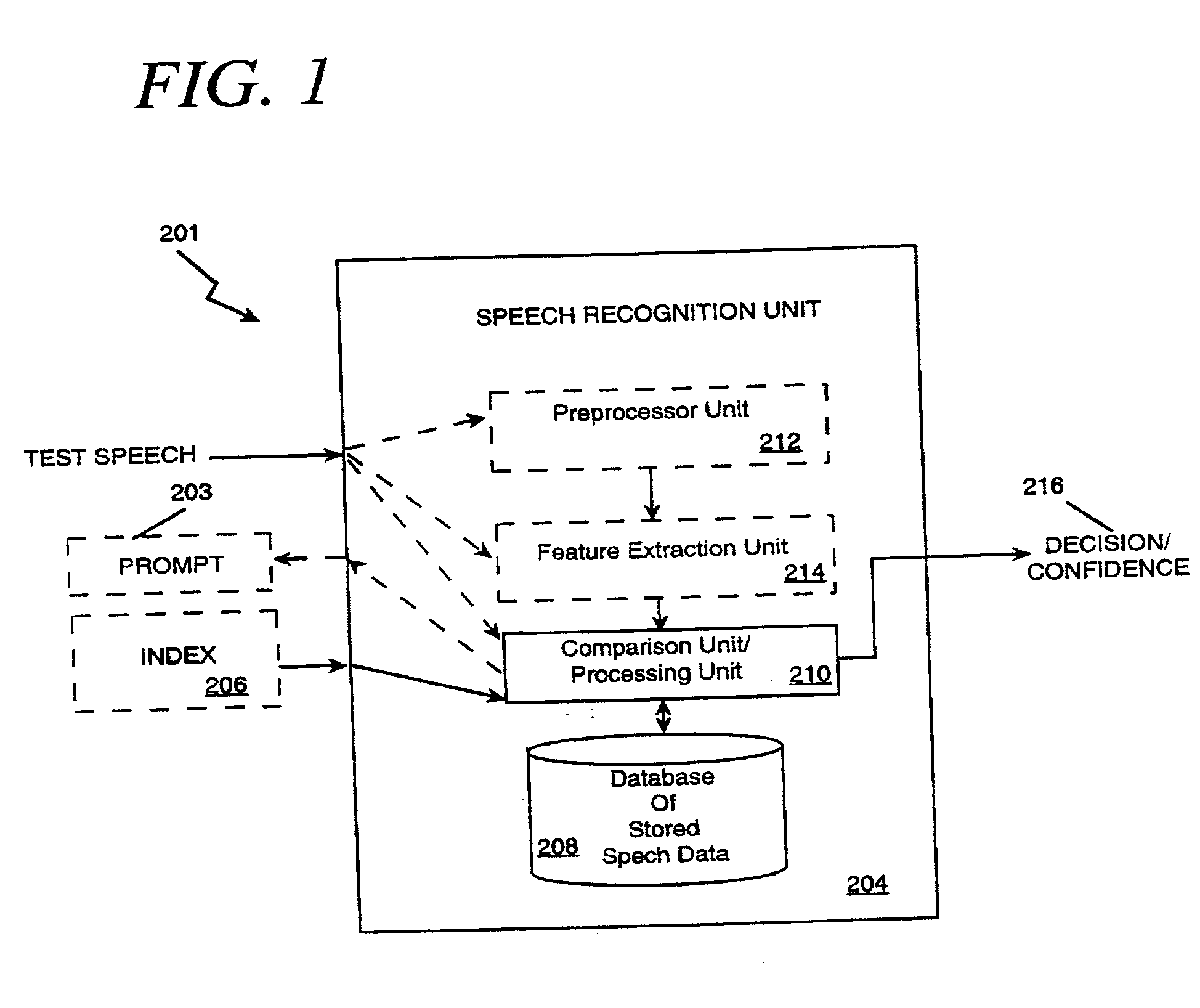

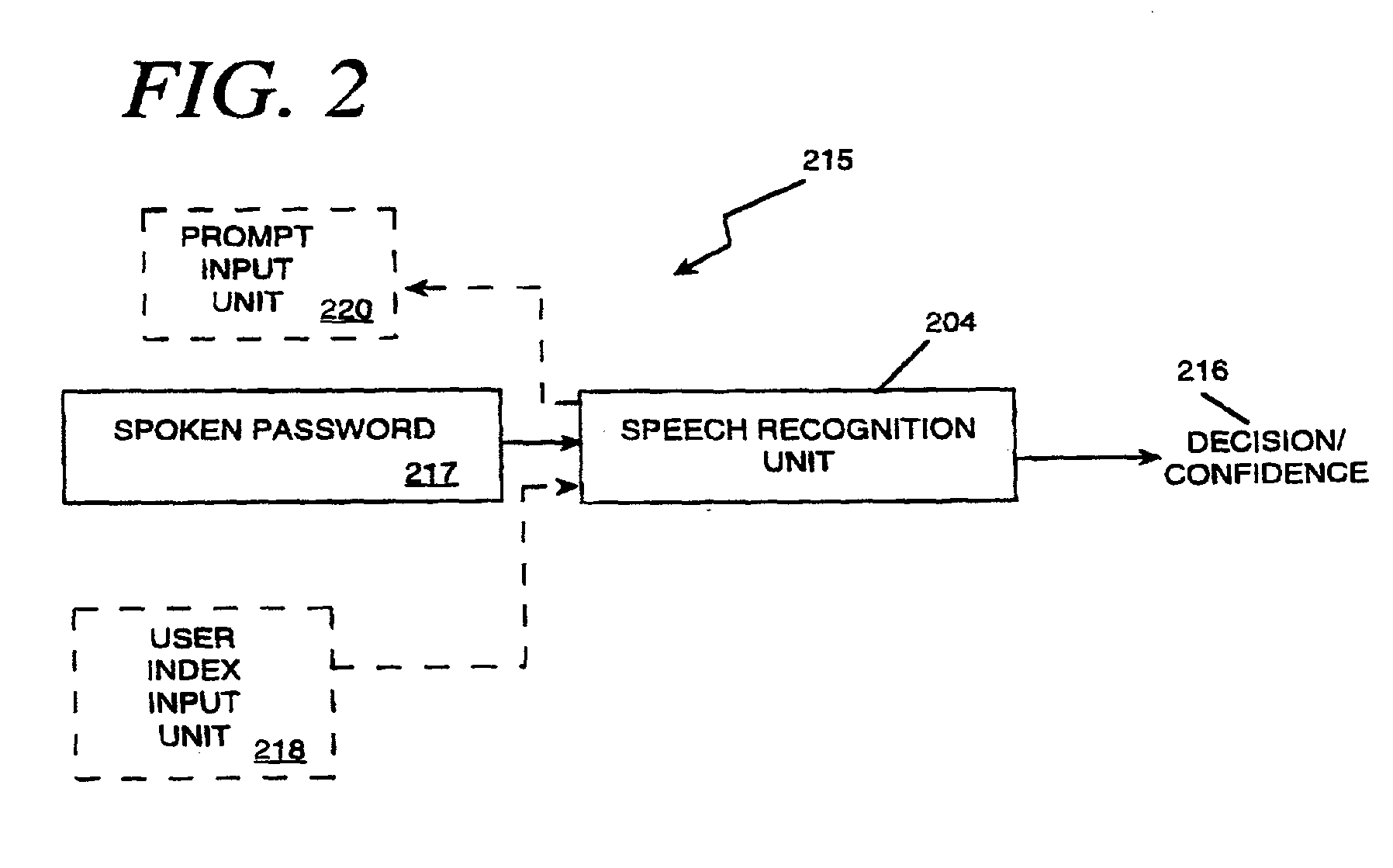

User validation for information system access and transaction processing

InactiveUS20030046083A1Robust methodPayment architectureDigital data authenticationUser verificationSpeech identification

The present invention applies speech recognition technology to remote access, verification, and identification applications. Speech recognition is used to raise the security level of many types of transaction systems which previously had serious safety drawbacks, including: point of sale systems, home authorization systems, systems for establishing a call to a called party (including prison telephone systems), internet access systems, web site access systems, systems for obtaining access to protected computer networks, systems for accessing a restricted hyperlink, desktop computer security systems, and systems for gaining access to a networked server. A general speech recognition system using communication is also presented. Further, different types of speech recognition methodologies are useful with the present invention, such as "simple" security methods and systems, multi-tiered security methods and systems, conditional multi-tiered security methods and systems, and randomly prompted voice token methods and systems.

Owner:BANK ONE COLORADO NA AS AGENT +1

Cashless vending transaction management by a vend assist mode of operation

InactiveUS7076329B1International currency conversion processing fees are minimizedApparatus for meter-controlled dispensingAutomatic teller machinesPaymentTransaction management

The present invention relates to a cashless transaction processing system implementing a VEND ASSIST mode of operation to effectuate a cashless vending transaction. The VEND ASSIST mode allows a computing platform 802 to oversee, control, and authorize by way of a system 500 the vend selection and sale price of a user selected vend item prior to fulfilling the user's request.The cashless transaction processing system includes a system 500 and a computing platform 802. The system 500 initiates a vending session when certain commands from an interconnected computing platform 802 are received or in response to presentation, by a user, of valid payment identification data. Computing platform 802 data communicates a VEND APPROVE or VEND DENY response to a system 500 initiated REQUEST VEND APPROVE data communication. A vend cycle is then initiated or preempted as appropriate.

Owner:CANTALOUPE INC

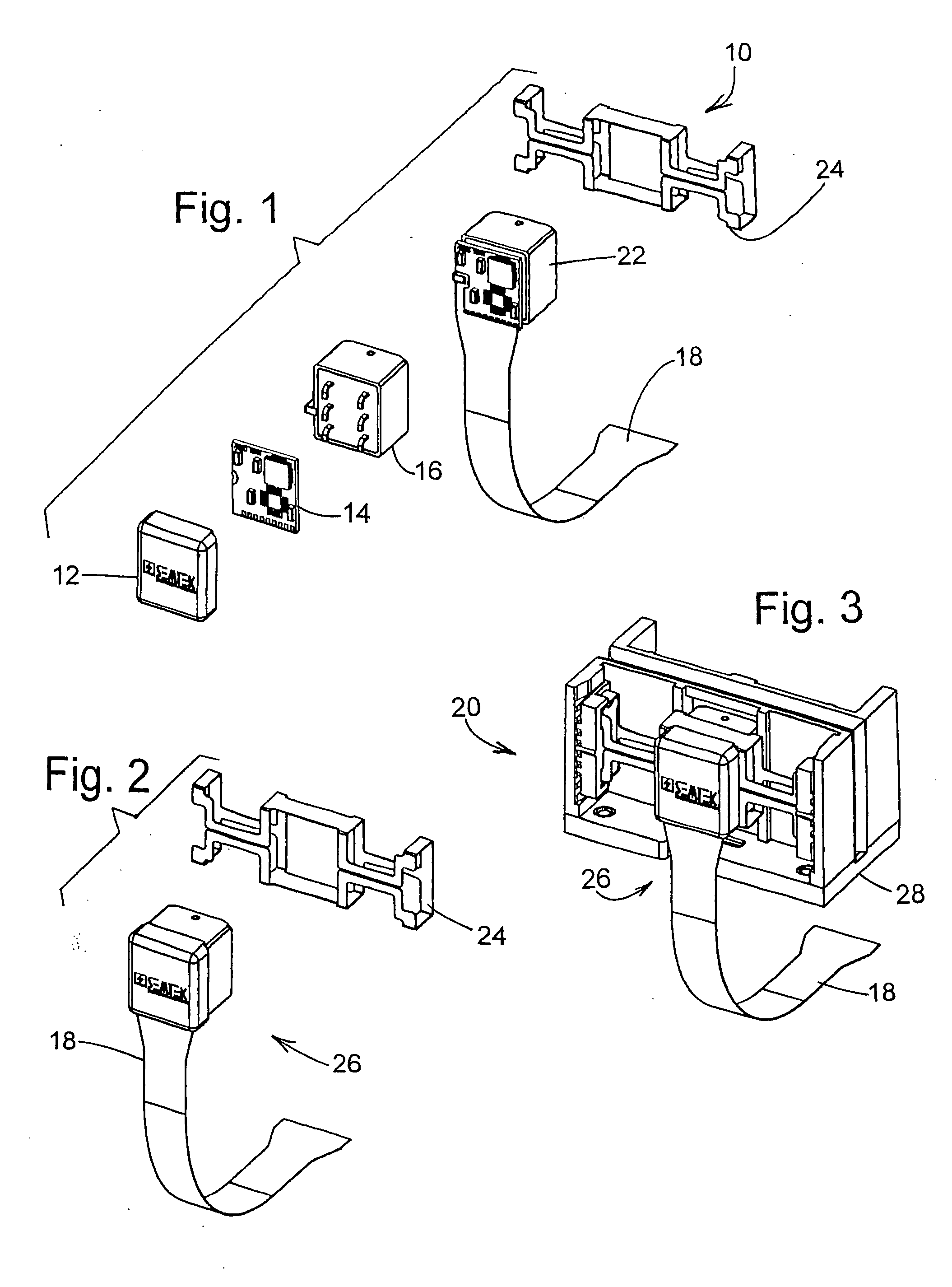

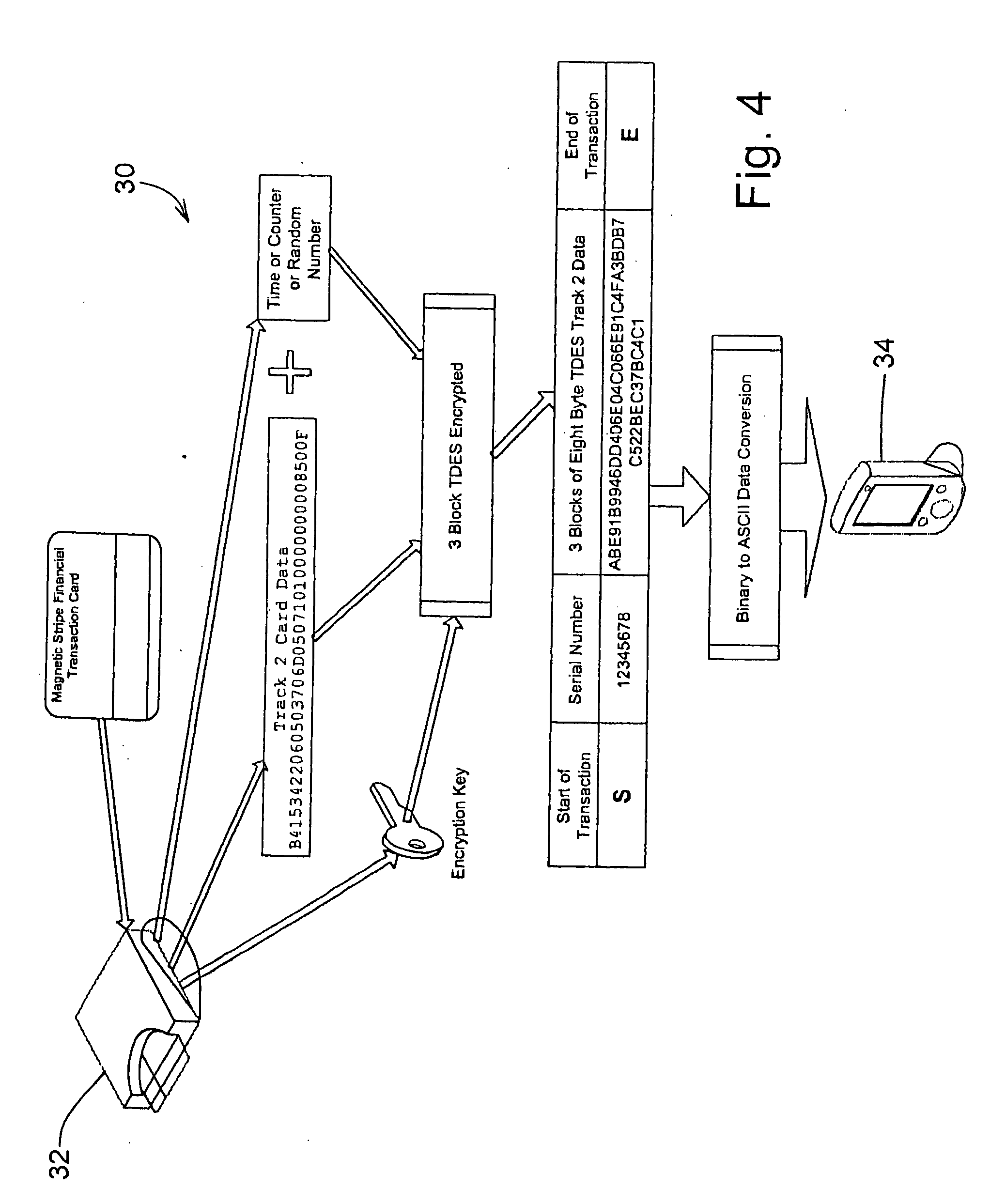

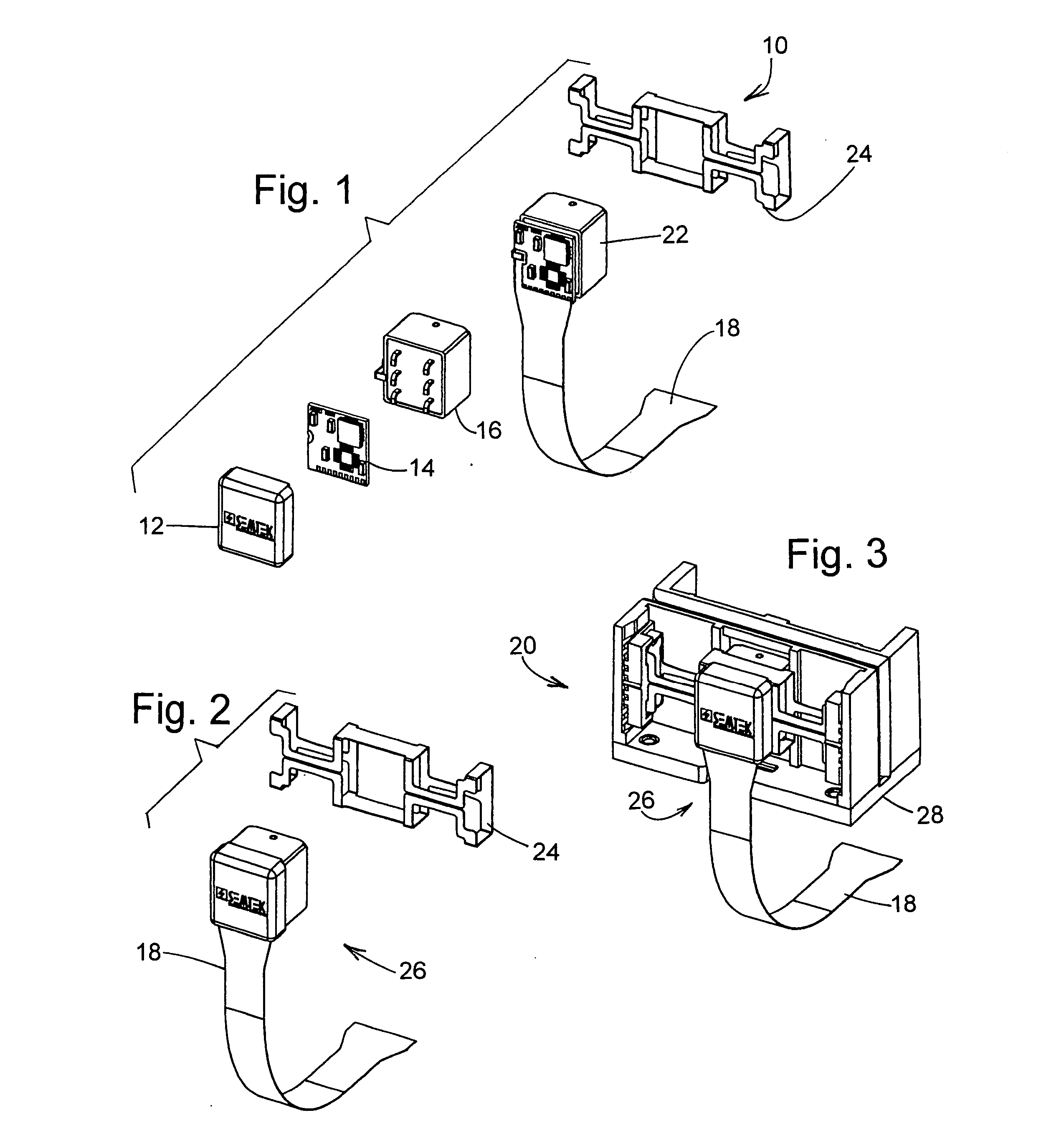

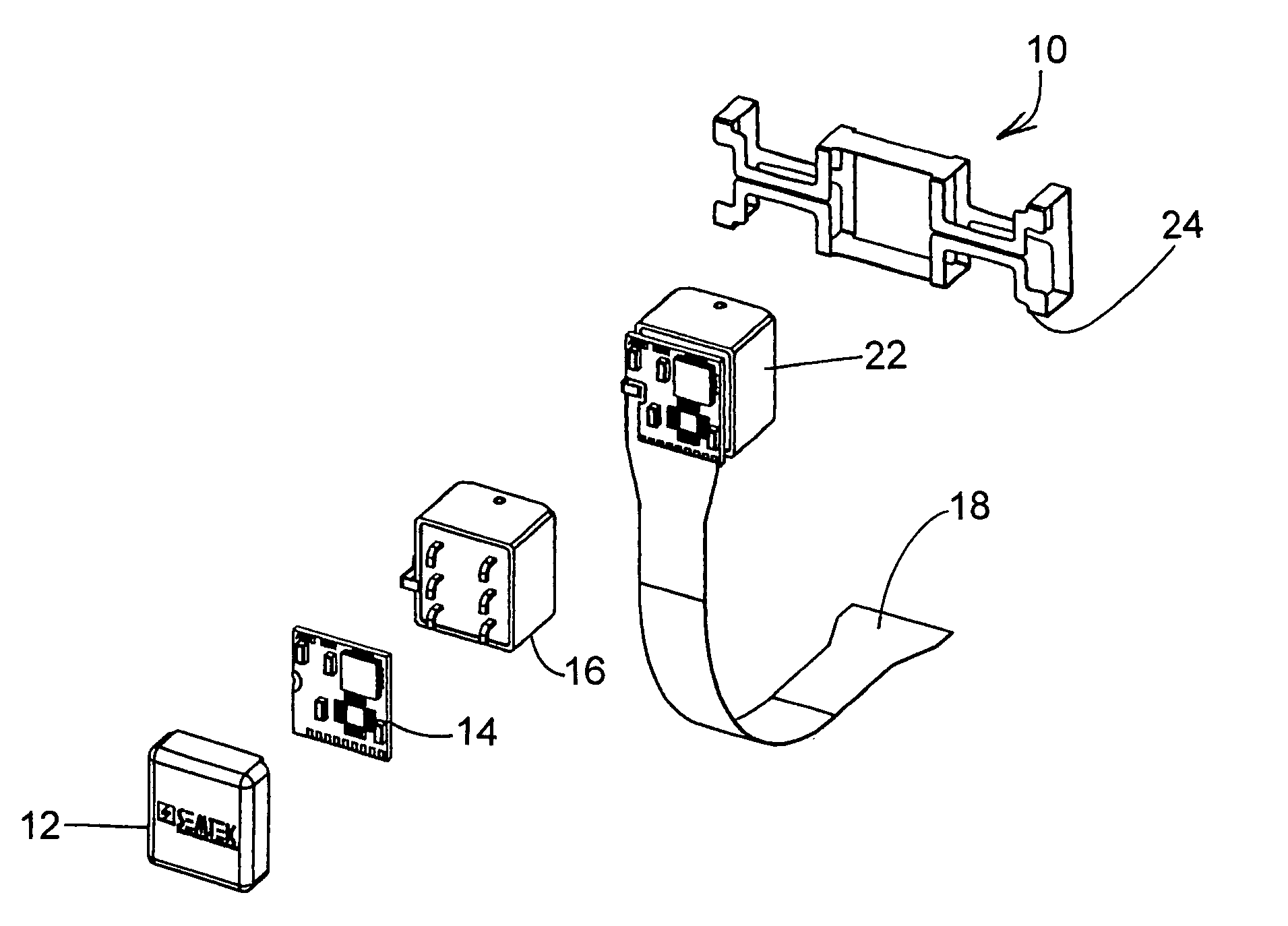

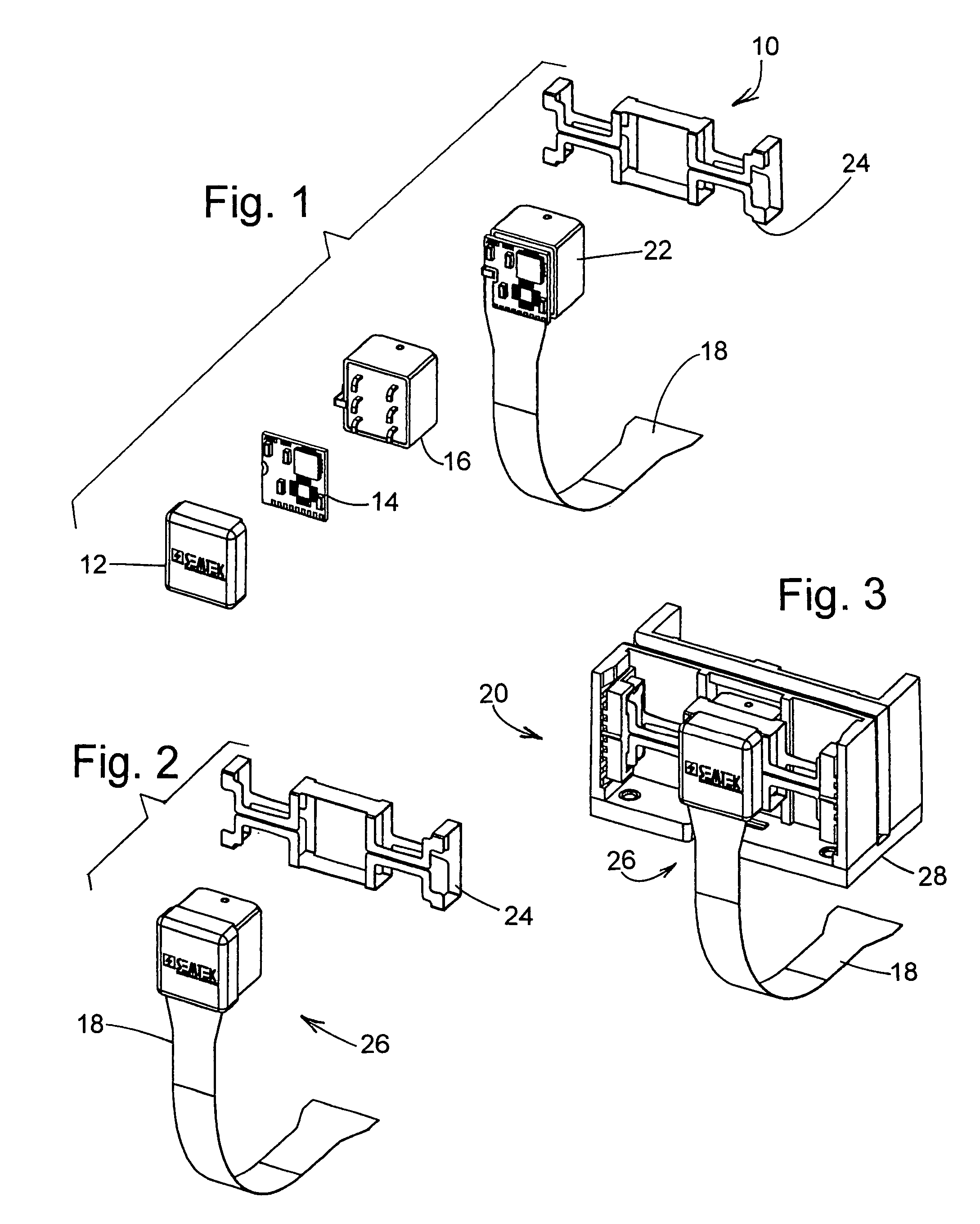

Secure magnetic stripe reader for handheld computing and method of using same

ActiveUS20060049255A1Support easily and efficientlyFunction increaseAcutation objectsFinanceInformation processingSoftware system

A secure magnetic stripe card stripe reader (MSR) module and software system capable of encrypting the magnetic stripe data to CISP standards for use in point of sale (POS) and other applications requiring data security using non secure networks and computing devices. Additionally, when incorporated within an attachment for conventional personal digital assistant (PDA) or cell phone or stationary terminal, provides encrypted data from the magnetic head assembly providing compliance with Federal Information Processing Standards Publication Series FIPS 140 covering security and tampering standards. Moreover, this module and software system includes the capability of providing secure POS transactions to legacy transaction processing systems transparently to the existing infrastructure. Furthermore, this module and software system includes the capability of transparently providing detection of fraudulently copied magnetic stripe cards.

Owner:VERIFONE INC

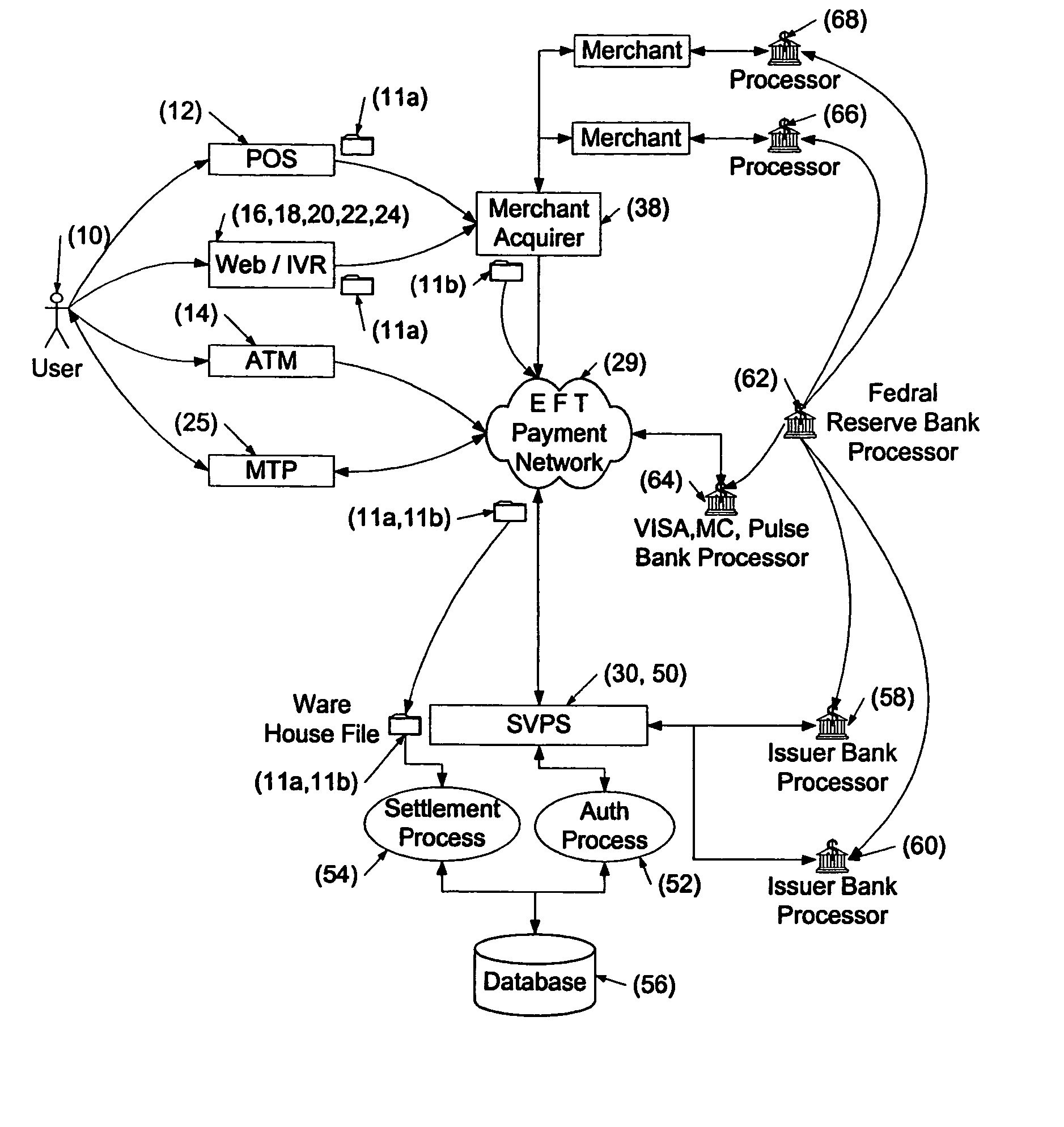

Cashless payment system

InactiveUS20050015332A1Without any loss of transaction processing flexibilityWidespread acceptanceFinanceBuying/selling/leasing transactionsComputer networkEngineering

A payment system that does not rely on credit or debit cards, does not require the merchant and purchaser to have compatible memberships to complete a transaction, and does not limit single transactions to a single account provides a wide range of flexibility permitting debit, credit, pre-paid and payroll cards to be accommodated in a seamless and invisible manner to the electronic transaction network. The transaction may be verified and approved at the point-of-sale whether or not the merchant is a member of a specific financial transaction system. Specifically, the point-of-sale transaction system permits an identified customer to use any of a variety of payment options to complete the transaction without requiring the merchant to pre-approve the type of payment selected by the customer. In one configuration, and in order to take advantage of the widespread use of the ATM / POS network, the invention uses a typical credit / debit card format to provide the identifying information in a stored value card. When a transaction is to be completed, the user enters the identifying information carried on the card at the point-of-sale. This can be a merchant or other service provider at a retail establishment, or on-line while the user is logged onto a web site, or other location. The information can be swiped by a card reader, or manually entered via a keyboard or other input device. The system supports a wide range of flexibility, permitting issuing systems such as parents and state welfare agencies to restrict the types of authorized uses, and permitting users to access accounts in a prioritized manner. Further, the accepting merchant is not required to be a member because settlement with the merchant may be made via the Federal Reserve Automatic Clearing House (ACH) system by typical and standard electronic transfer. This permits the merchant to take advantage of the lower ACH transaction fees with even greater convenience and flexibility than the current ATM / POS system. The system supports numerous types of identification methods from typical credit card structures with magnetic data strips to various biometric systems such as finger prints, facial recognition and the like. Specifically, once the user is identified, the transaction is managed by his membership data on record with the transaction processing system.

Owner:ECOMMLINK

Systems, methods, and devices for combined credit card and stored value transaction accounts

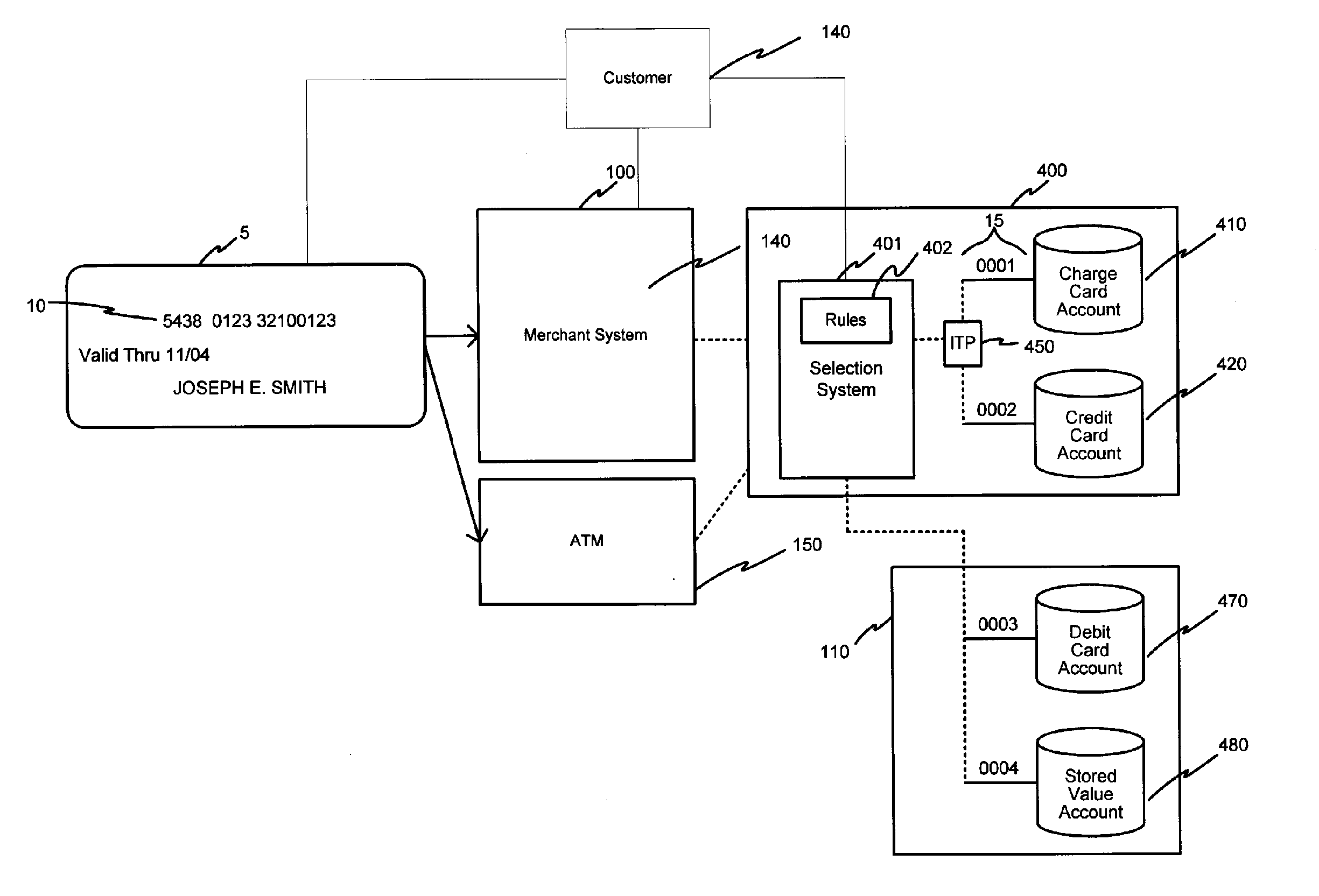

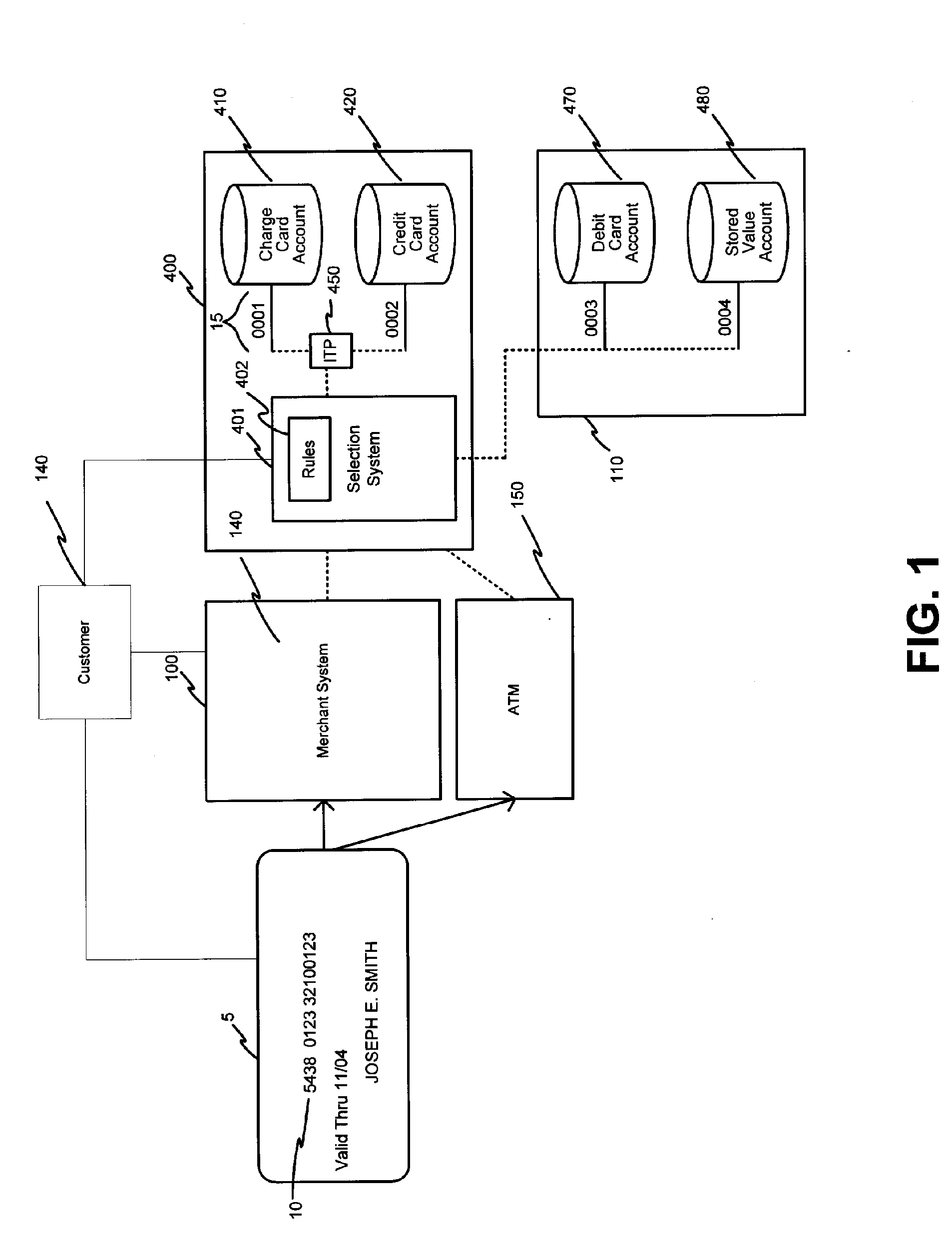

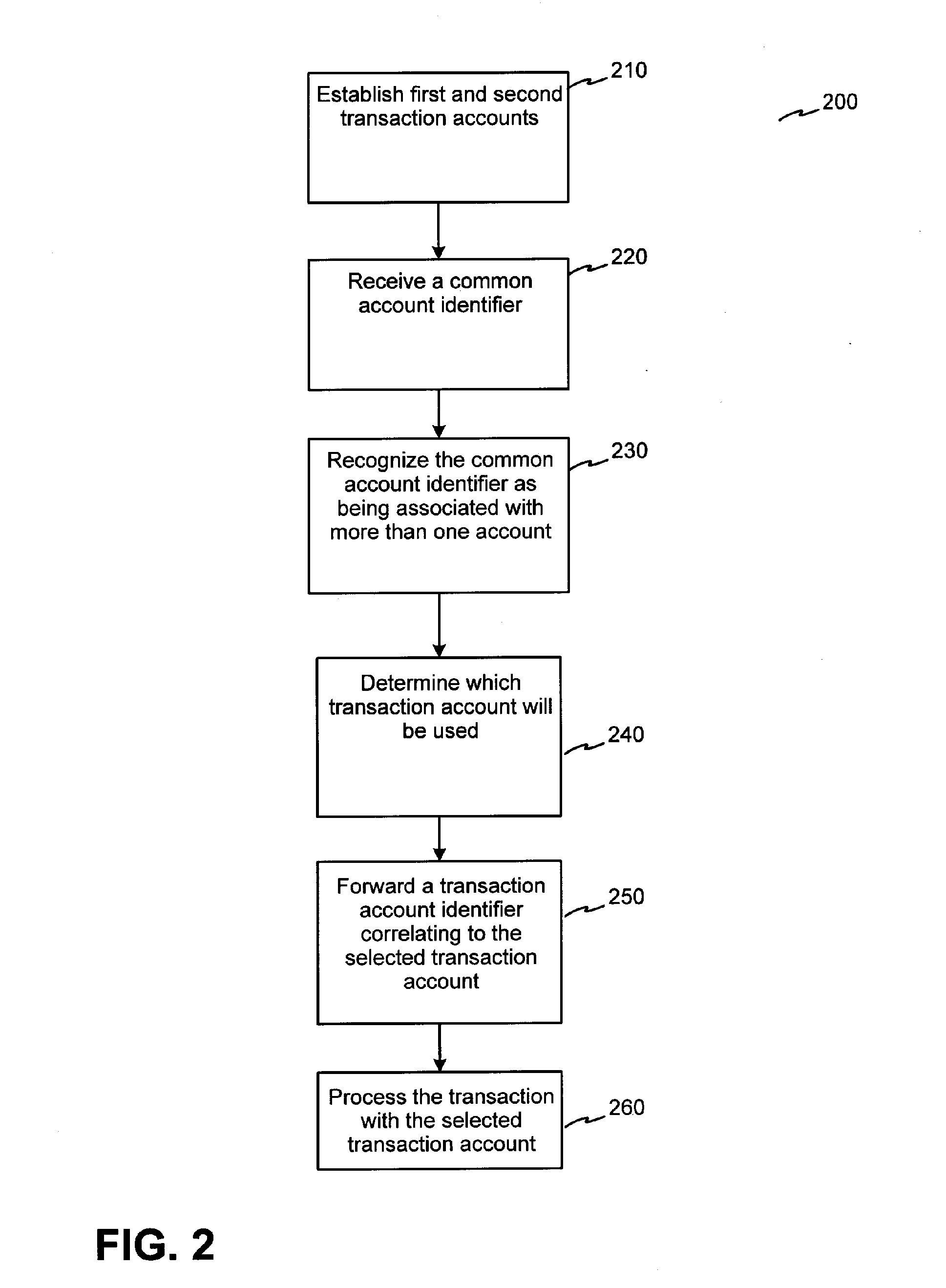

The present invention generally relates to a single transaction account identifier that can be used for in transactions with one of multiple transaction accounts. The method includes one or more of the following steps: establishing at least two transaction accounts, wherein the transaction accounts are respectively associated with transaction account identifiers; receiving, at a transaction processing system, a common account identifier; recognizing the common account identifier as being associated with more than one account; and determining, which of the at least two transaction accounts to access for processing the transaction. The determining step may be based on selection criteria and the selection criteria may be modified by a user. One of the first and second transaction account identifiers may be forwarded to the respective first and second transaction accounts based on the determining step; and the transaction may be processed via the selected transaction account.

Owner:LIBERTY PEAK VENTURES LLC

Electronic savings transfers

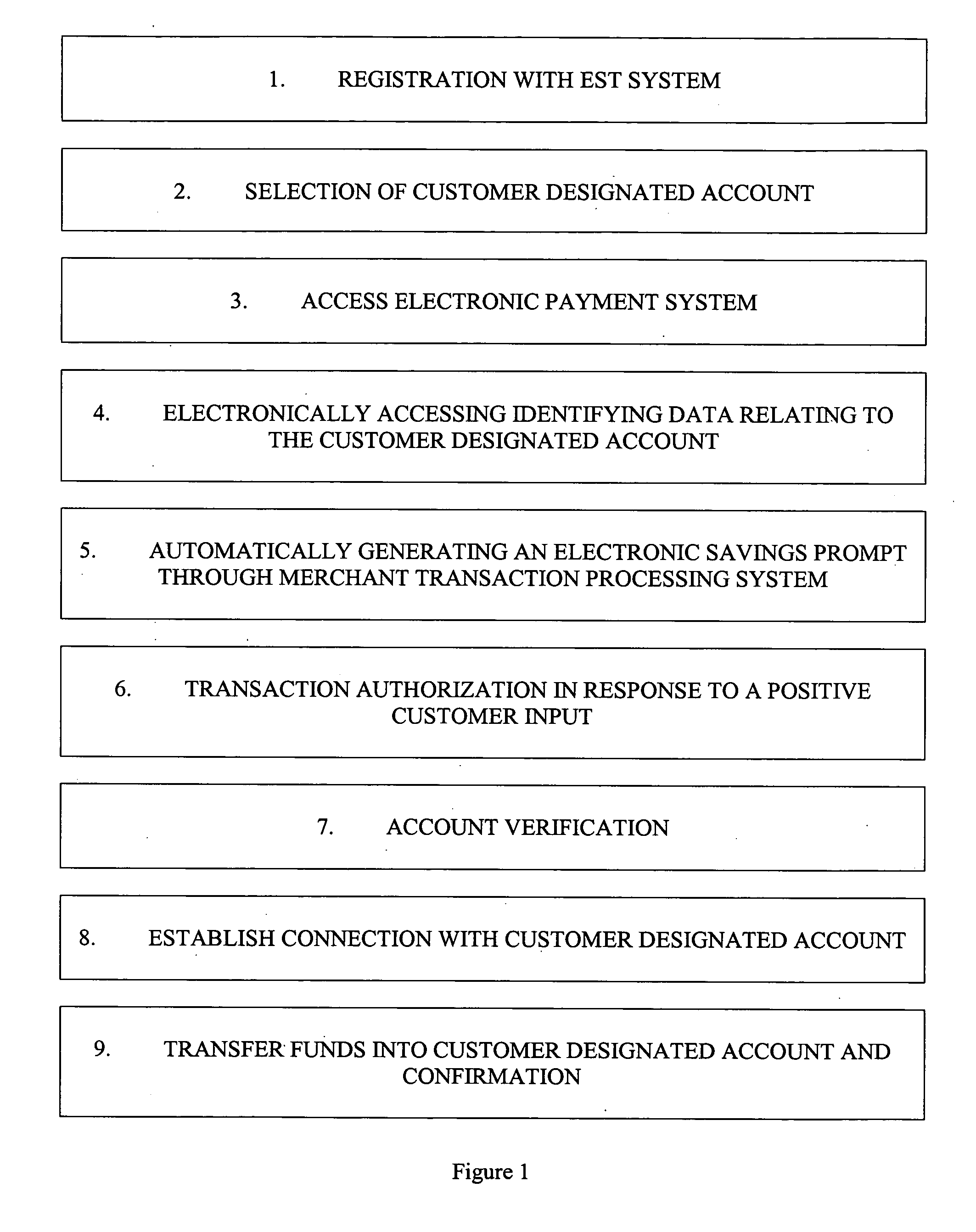

A system and method is provided for directing the transfer of funds to a customer designated account at a electronic payment system terminal, the method comprising the steps of: a) establishing a customer designated account capable of being accessed through the transaction processing system associated with a merchant, where the transaction processing system is communicatively linked to the customer designated account; b) accessing identifying data relating to the customer designated account through an electronic payment system terminal communicatively linked to the transaction processing system; c) automatically generating an electronic savings prompt for a customer at the electronic payment system terminal; and d) in response to a positive customer input to the savings prompt establishing a connection to the customer designated account and transferring funds into the customer designated account.

Owner:HYBRID KIOSKS

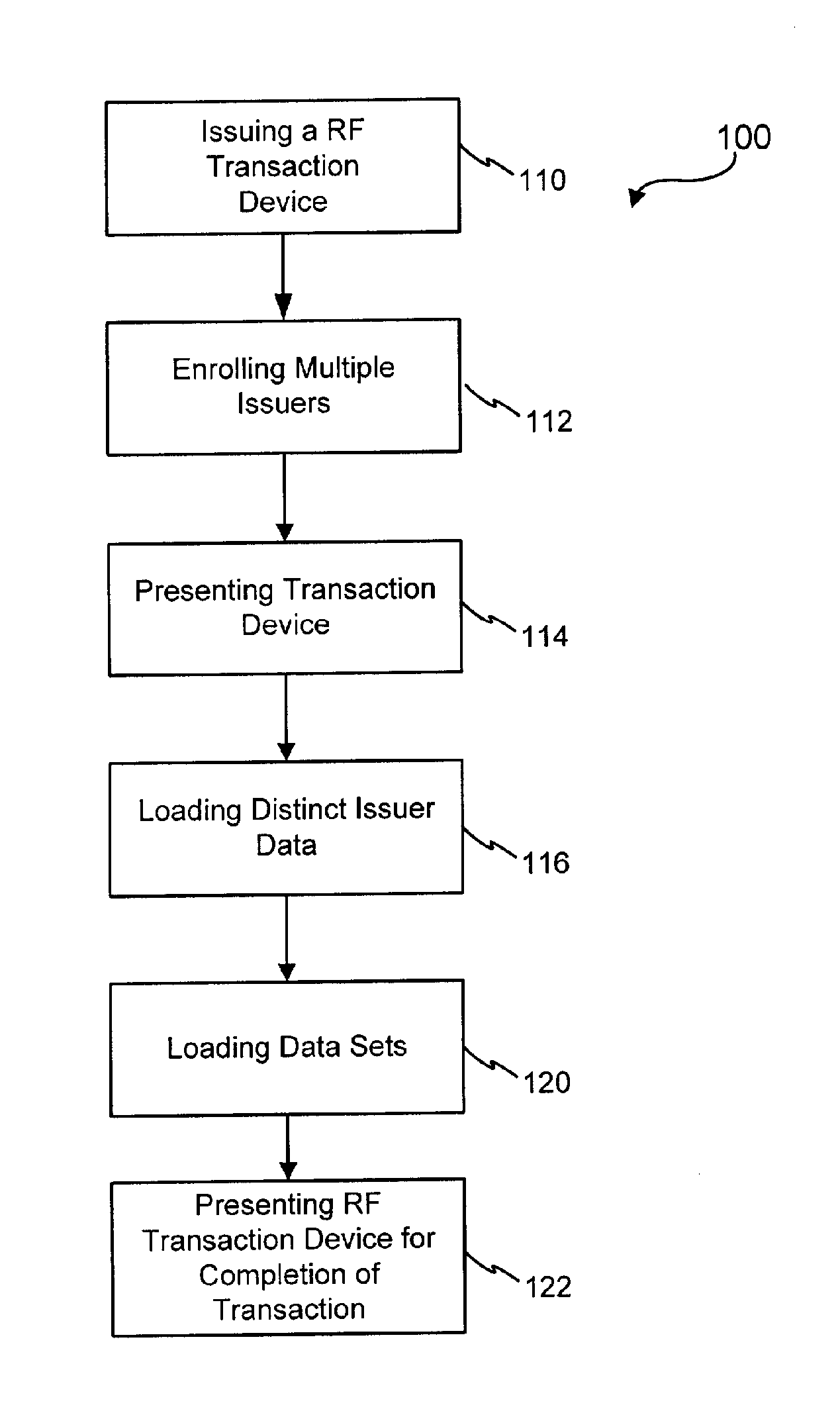

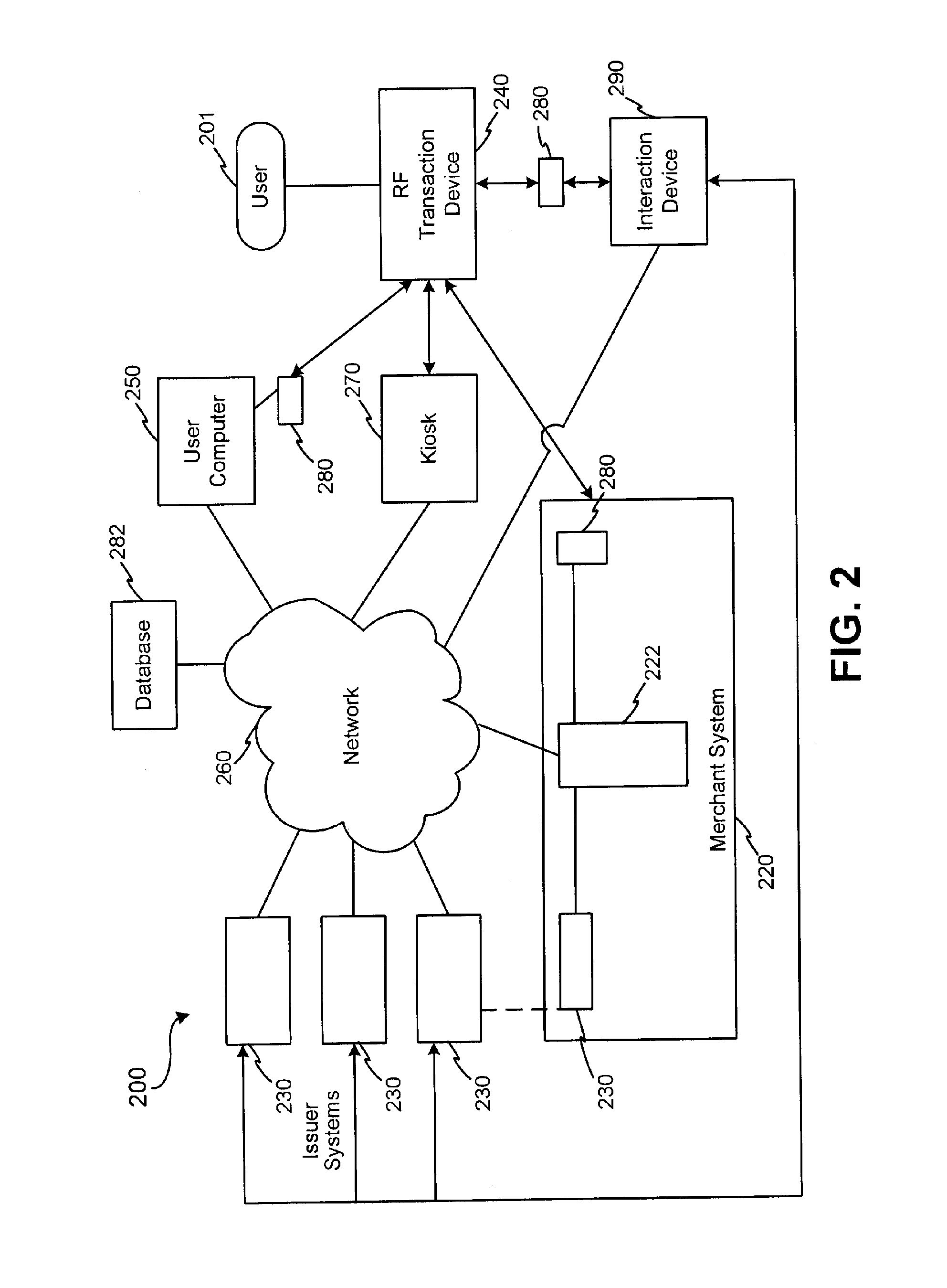

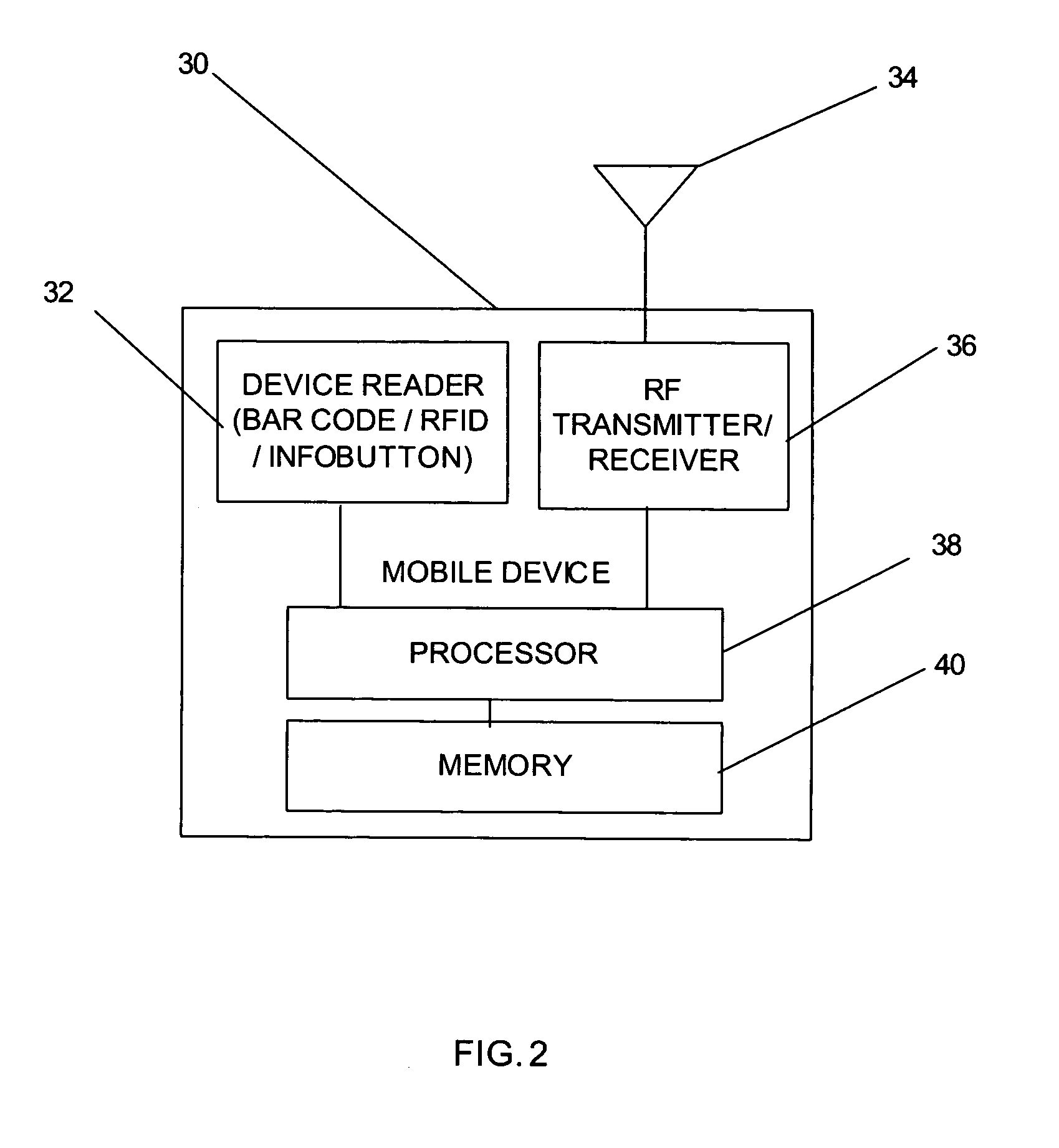

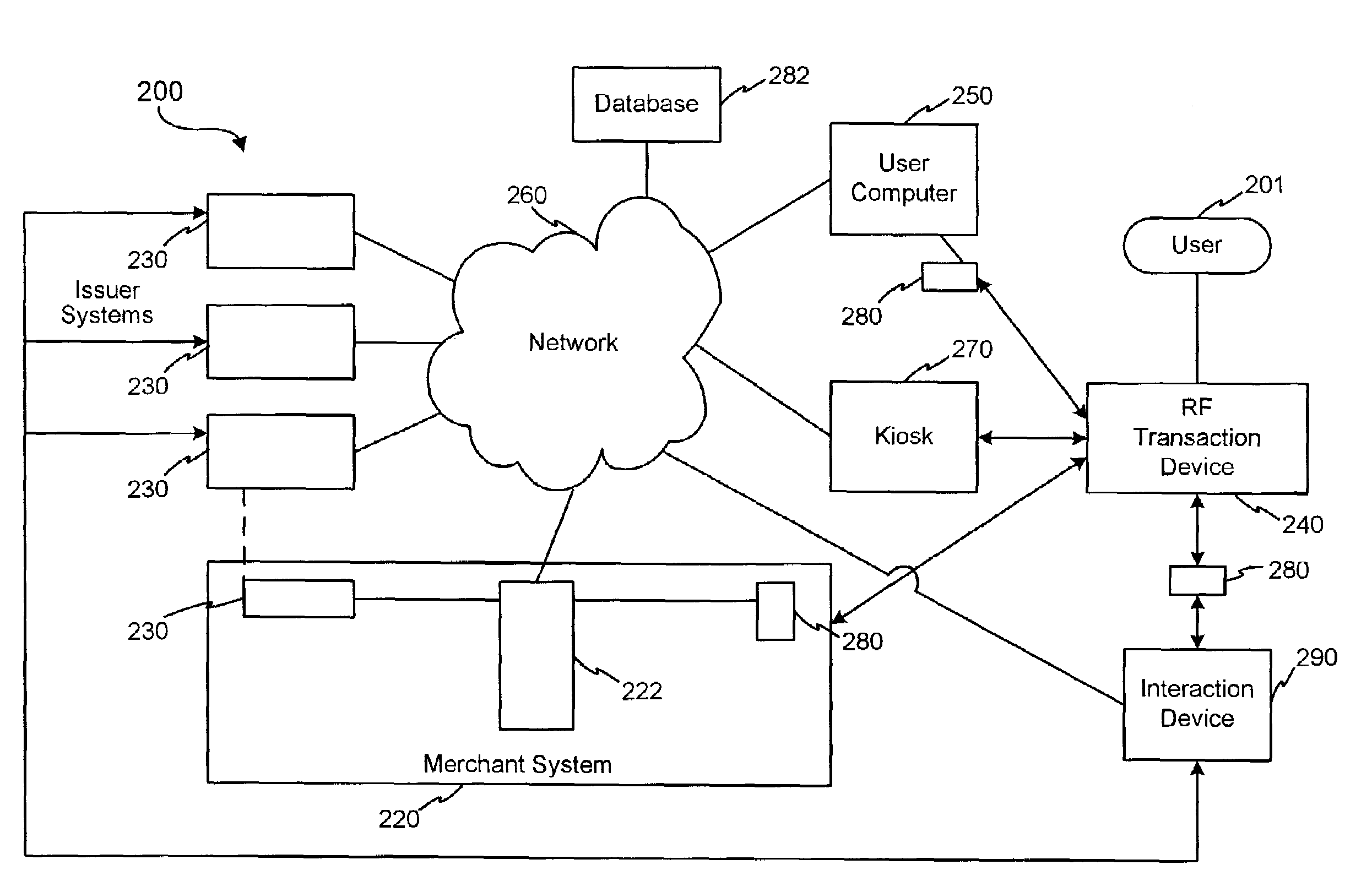

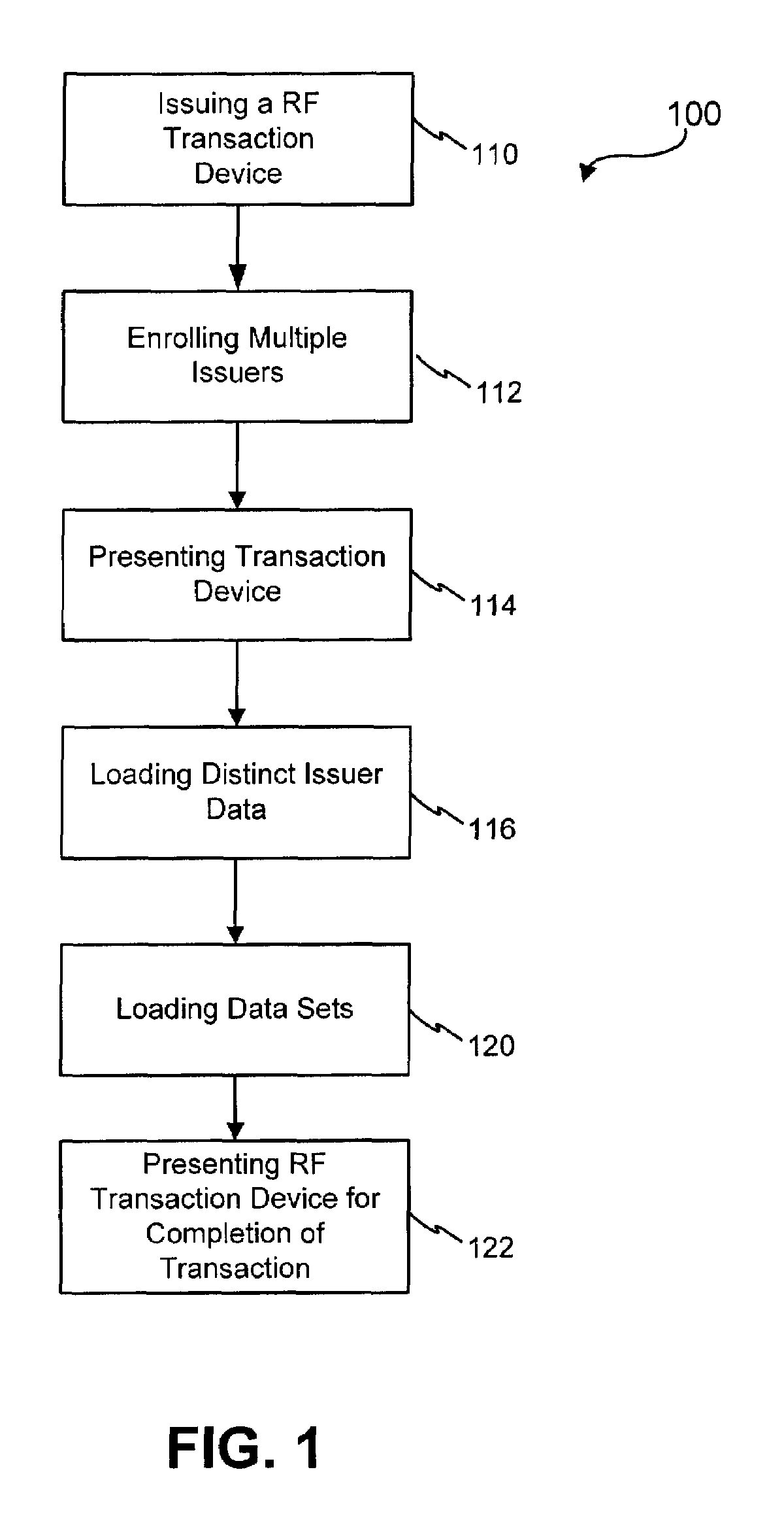

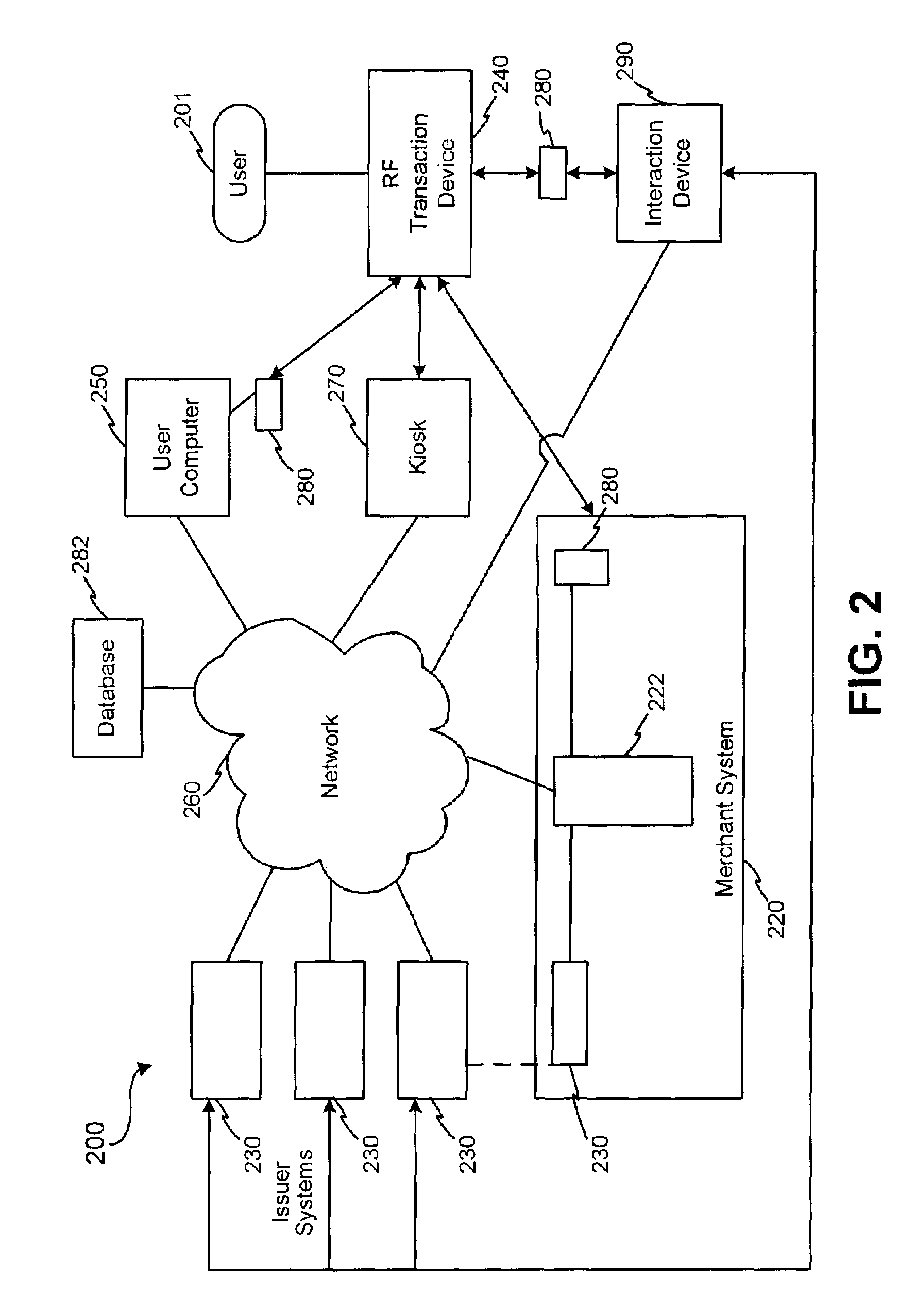

Systems and methods for providing a RF transaction device for use in a private label transaction

InactiveUS20050035847A1Reduce needImage analysisDigital data processing detailsHandling systemTransaction processing system

A RF transaction device is provided, which is operable to store a private label transaction account identifier associated with a private label transaction account. The invention further includes a RF operable reader in communication with a private label transaction processing system. The RF transaction device communicates with the reader to provide the private label transaction account identifier to the transaction processing system. As such, the invention provides a RF transaction device which may be used to complete a transaction using RF frequency in a contactless environment.

Owner:LIBERTY PEAK VENTURES LLC +1

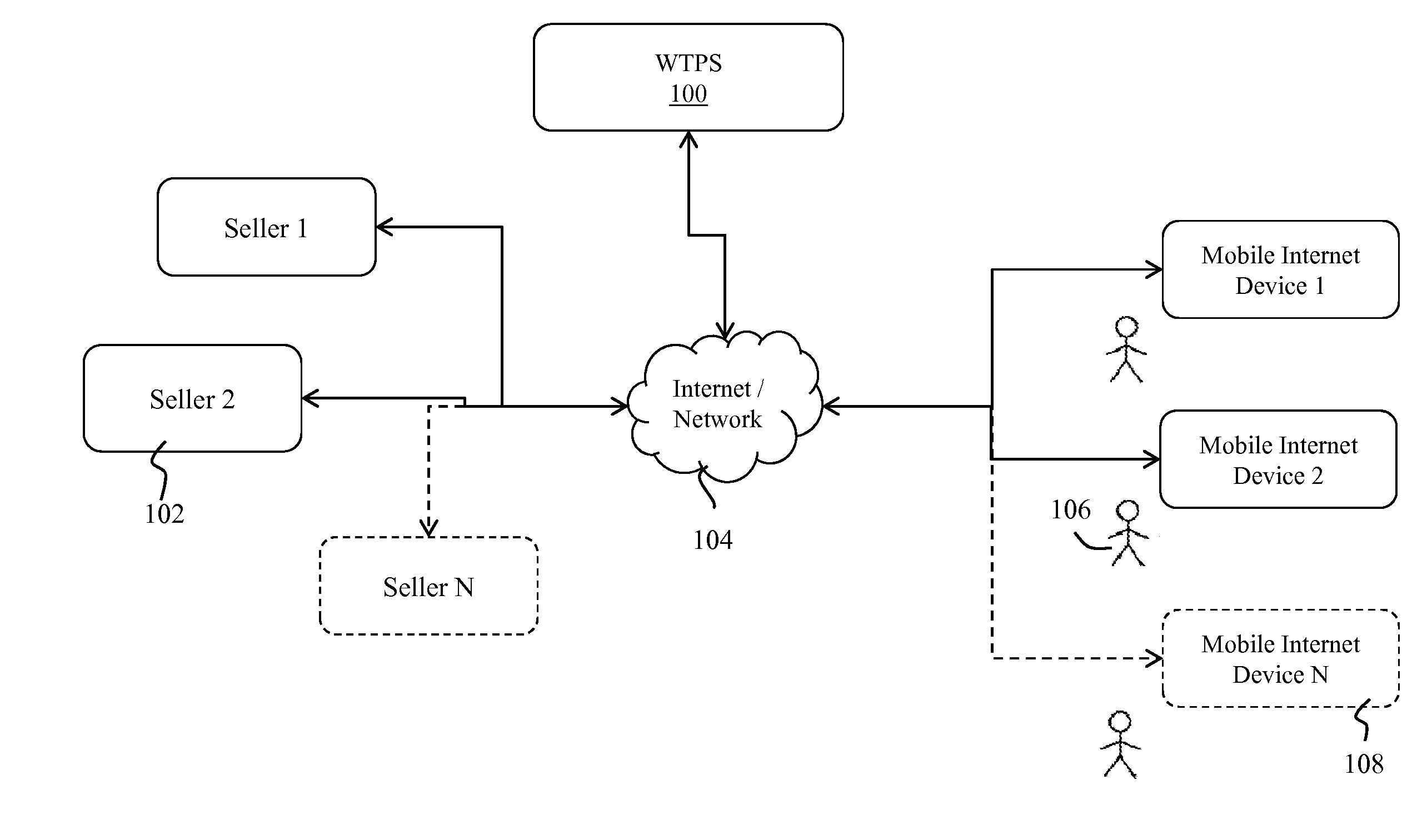

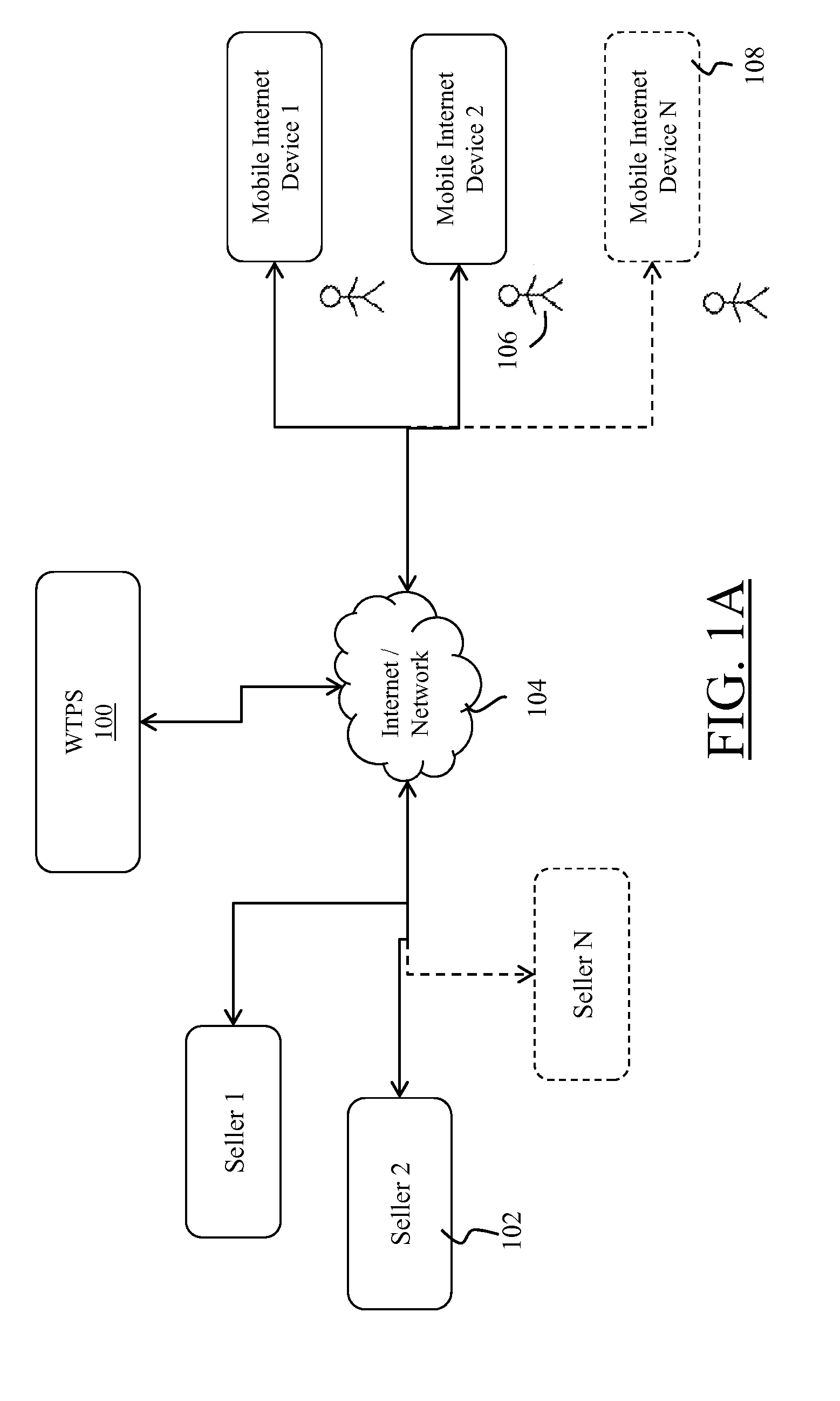

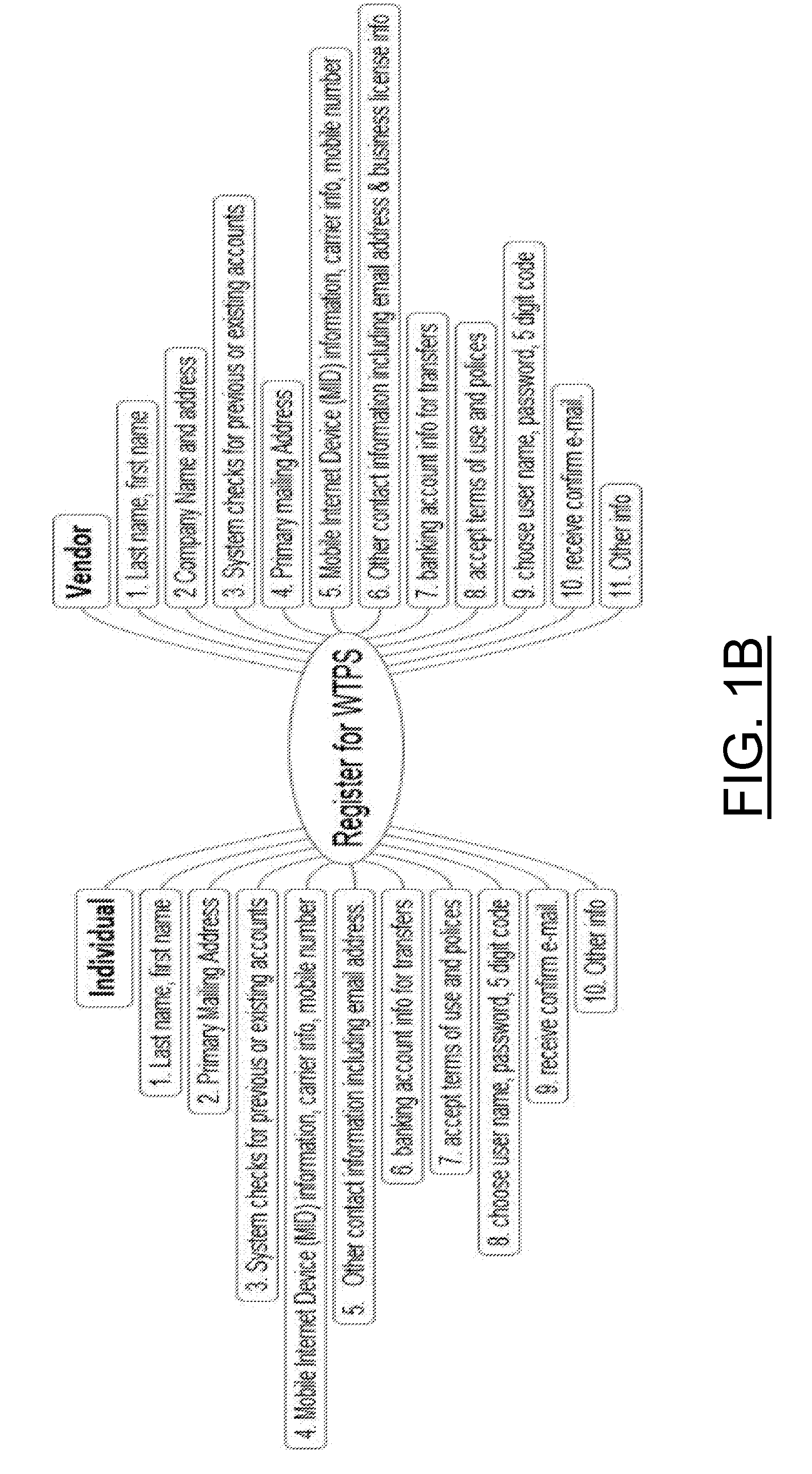

Contactless wireless transaction processing system

InactiveUS20120203664A1Accounting/billing servicesTelephonic communicationThe InternetTransaction processing system

A wireless transaction processing system, comprising a member seller associated with a data that has a machine-readable representation, and a member buyer having at least an Internet enabled device that can access the wireless transaction processing system. The wireless transaction processing system, through the Internet enabled device of the buyer identifies the buyer, including buyer physical location, receives the machine-readable representation of the data, and displays the received data by the Internet enabled device of the buyer. The wireless transaction processing system wirelessly transmits the buyer information (including buyer location information) and received data for verification and approval of transaction between buyer and seller without exchange of confidential information between a buyer and a seller, and without requiring seller specialty equipment.

Owner:TYCOON UNLIMITED

Transaction processing systems and methods

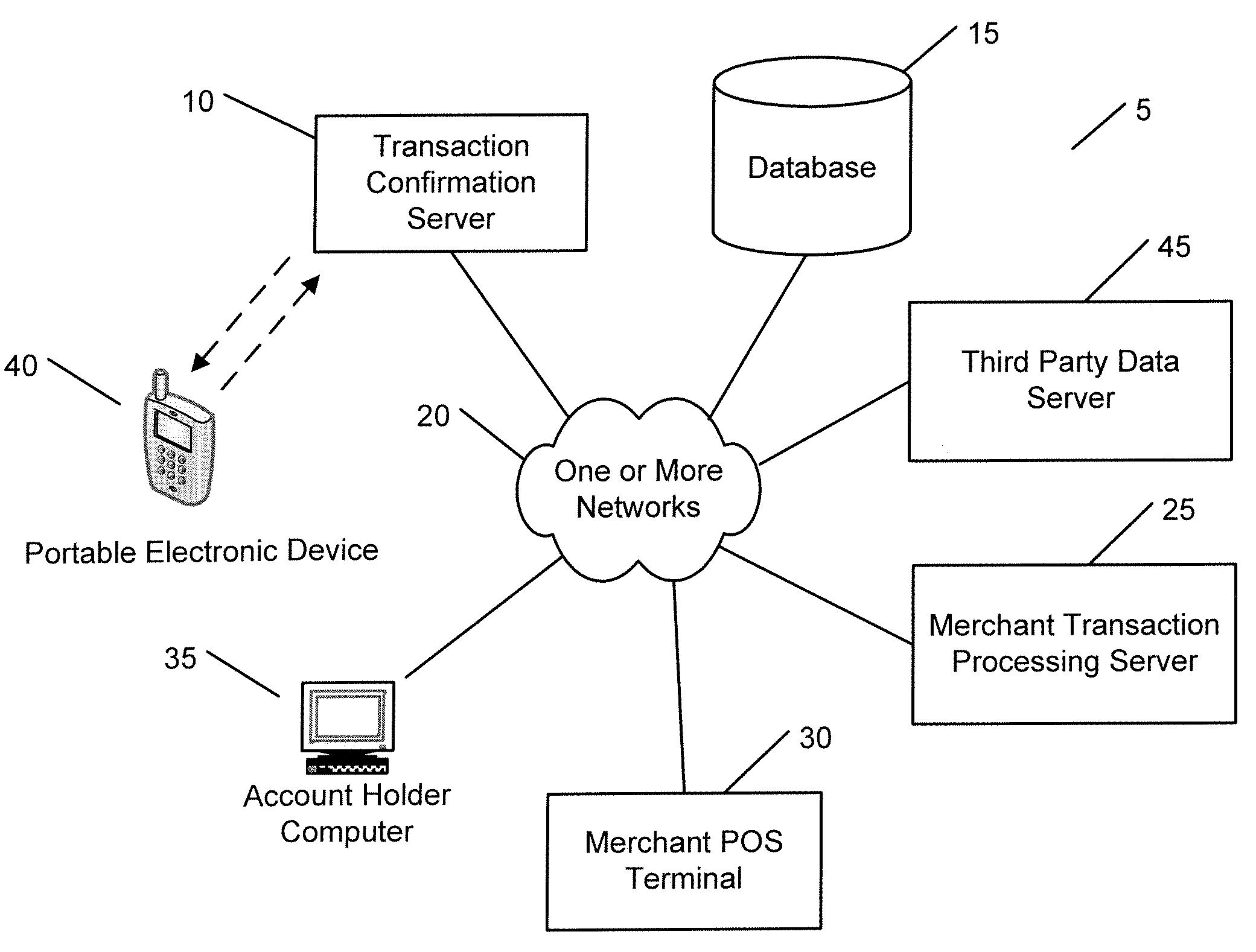

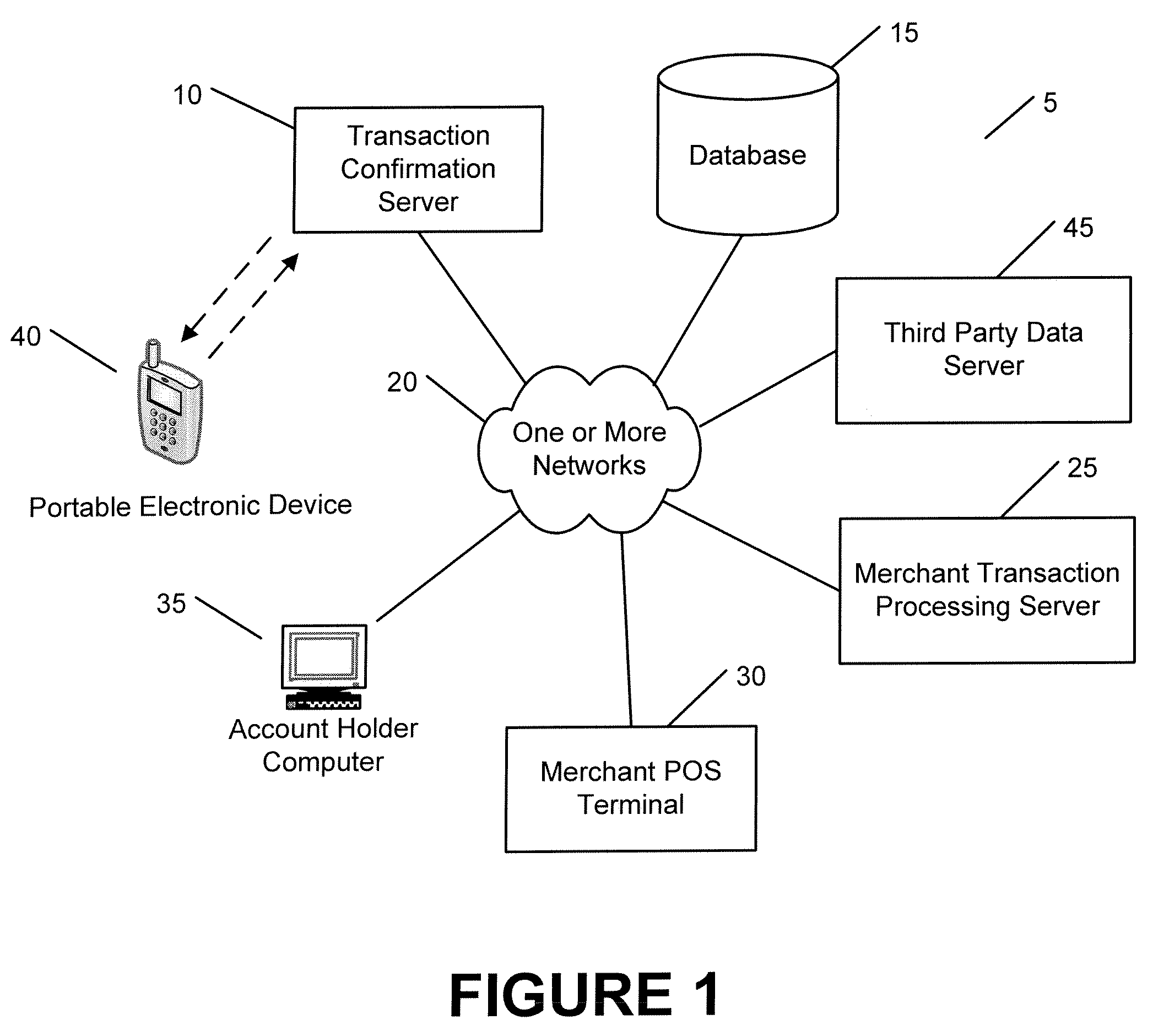

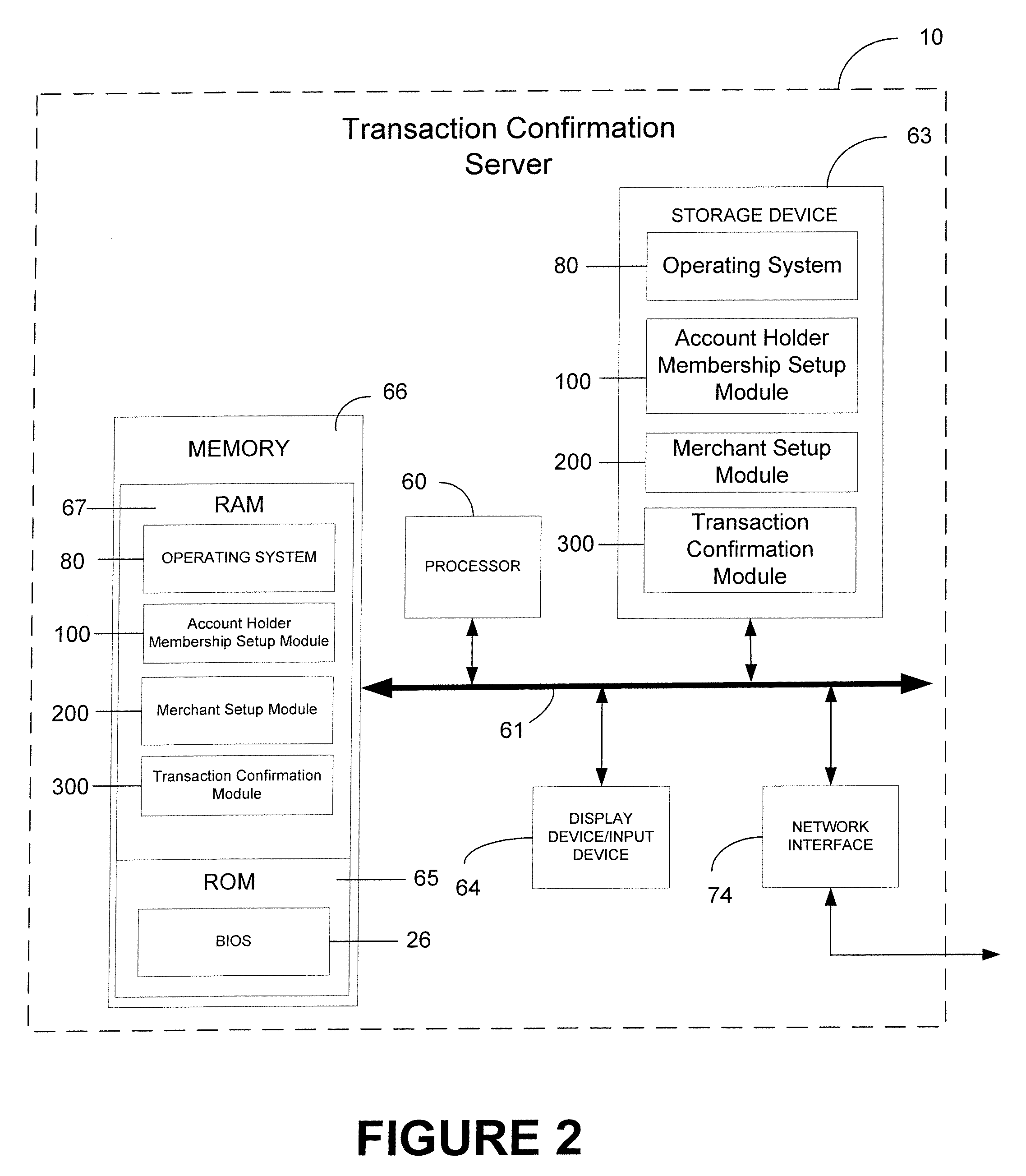

A transaction processing system according to various embodiments of the invention is adapted for: (1) associating a particular account (e.g., a credit card account) with a particular phone number; (2) at least partially in response to receiving a request to approve a transaction associated with the account, automatically transmitting a message (e.g., a text message) to the account holder via the phone number, requesting that the account holder confirm that the transaction is valid; and (3) using a response to the message to determine whether to approve or deny the transaction. In various embodiments, the request confirmation message requests that that the user answer a particular question (e.g., regarding out-of-wallet data), and the system is adapted to determine whether to approve or deny the transaction based on whether the response included a correct answer to the question.

Owner:GULA CONSULTING LLC

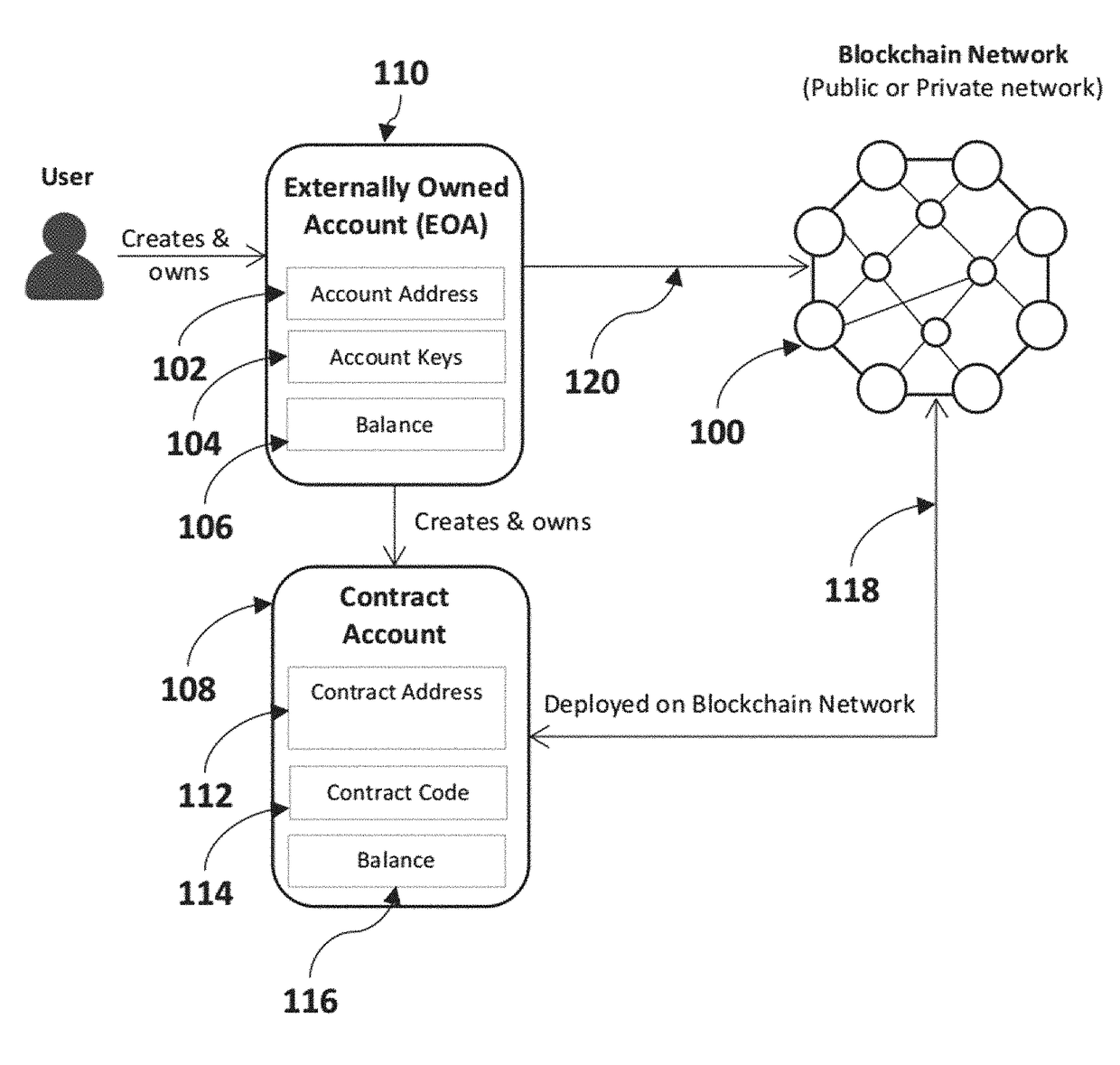

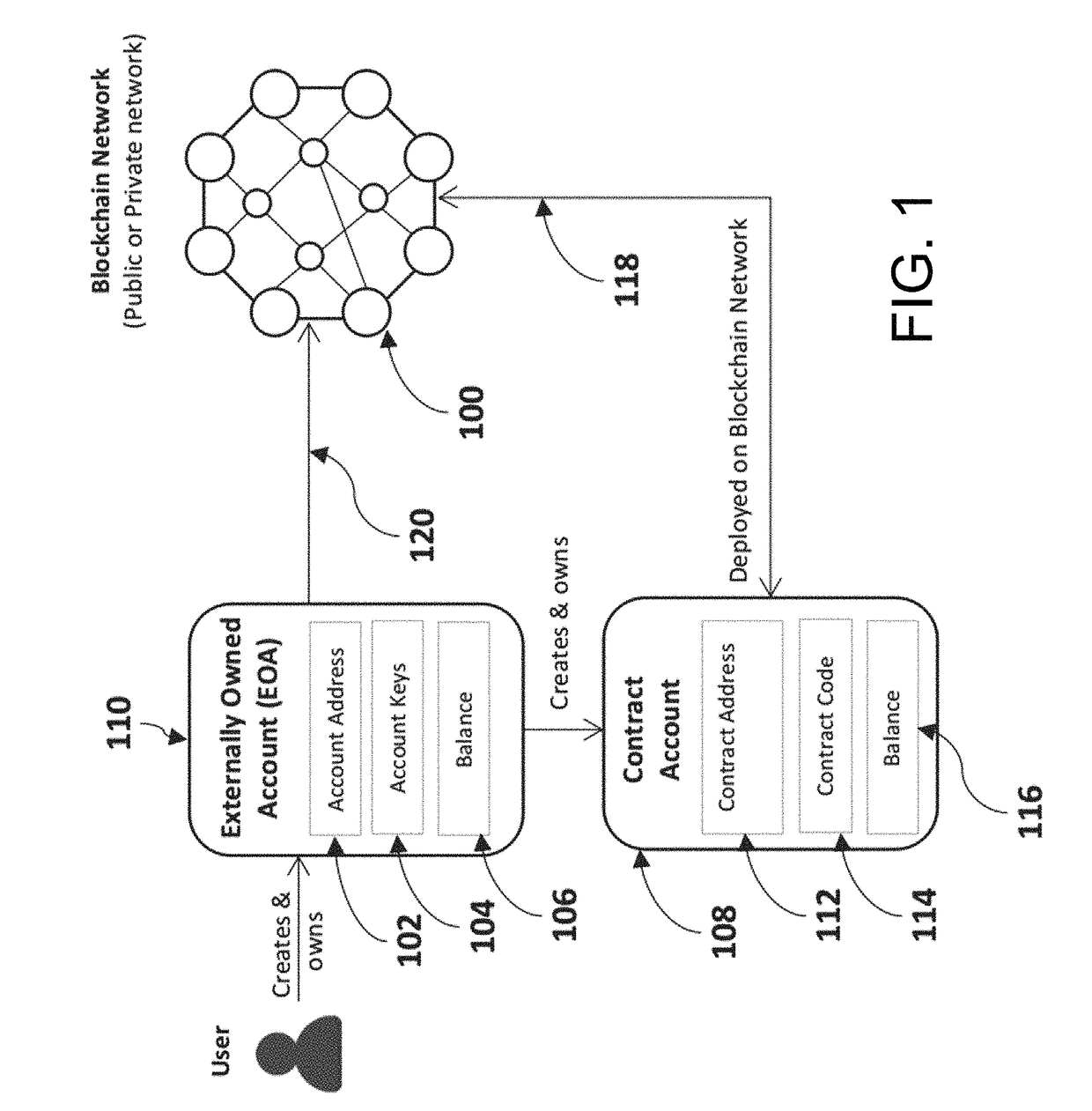

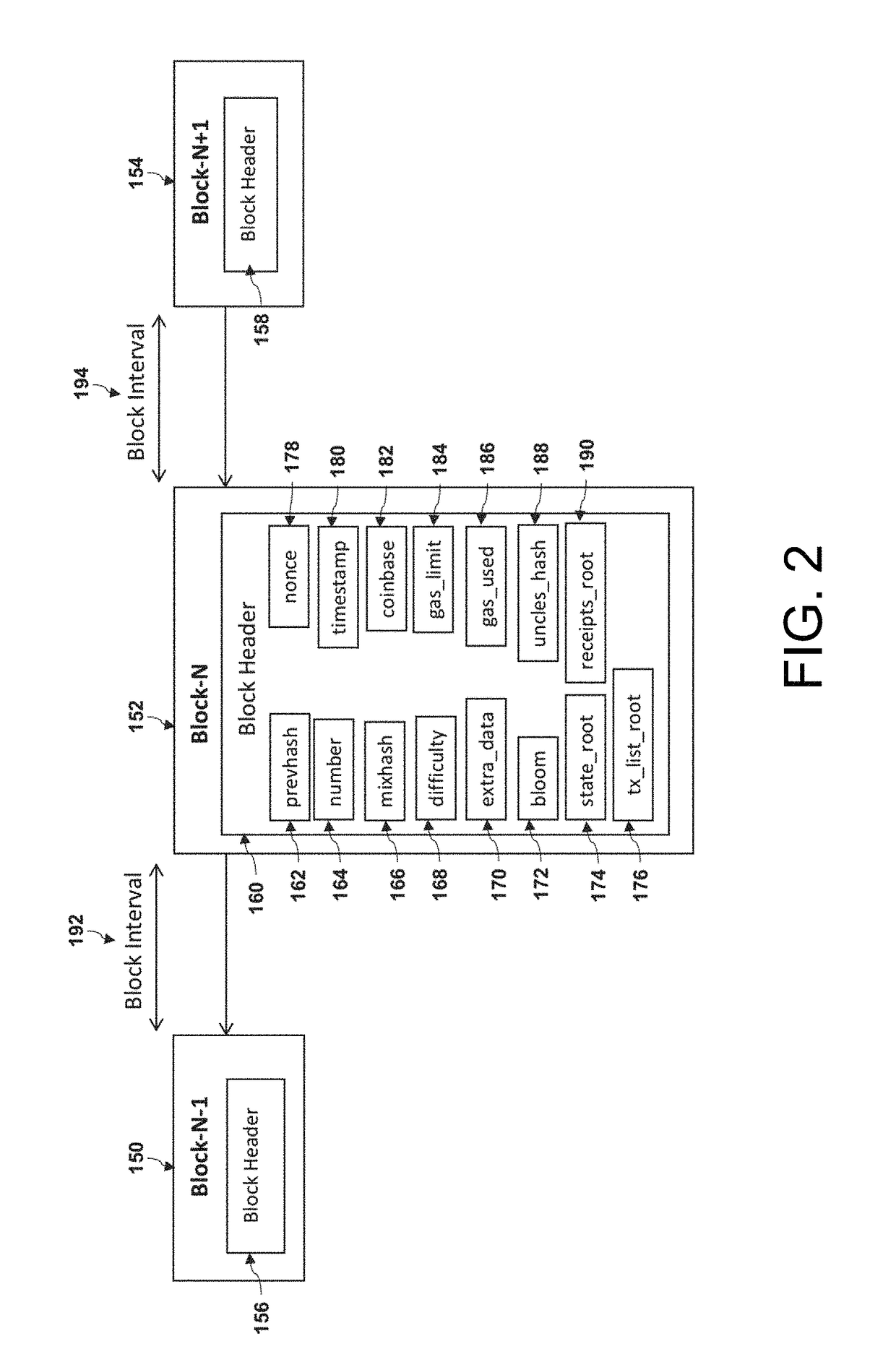

Method and system for tuning blockchain scalability for fast and low-cost payment and transaction processing

ActiveUS10102265B1Privacy protectionScalability issueEncryption apparatus with shift registers/memoriesCryptography processingPaymentSmart contract

A method of synchronizing transactions between blockchains comprising receiving first and second pluralities of transactions on a first private blockchain network and recording them to first and second private blocks on the first private blockchain network, respectively, generating a first merged block comprising the first private block and the second private block and recording the first merged block to a single block on a second blockchain network, recording each of the first and second private blocks and the first merged block to a first private smart contract linked to the first private blockchain network, performing a synchronization process between the first private smart contract and a second smart contract linked to the second blockchain network, defining a second smart contract, and performing a checkpointing process between the first private smart contract and the second smart contract. The first private blockchain network has a parameter difference from the second blockchain network.

Owner:MADISETTI VIJAY K

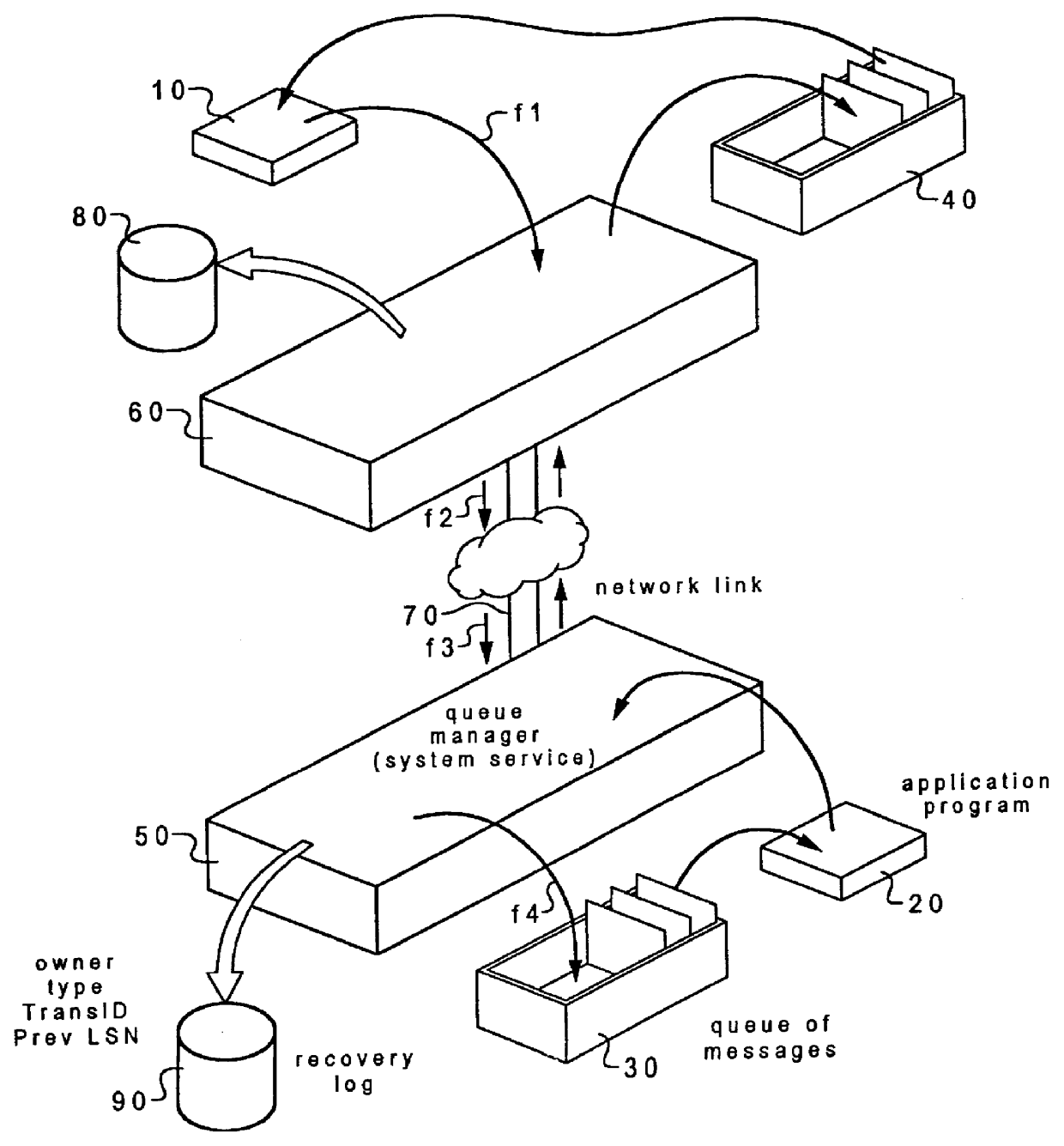

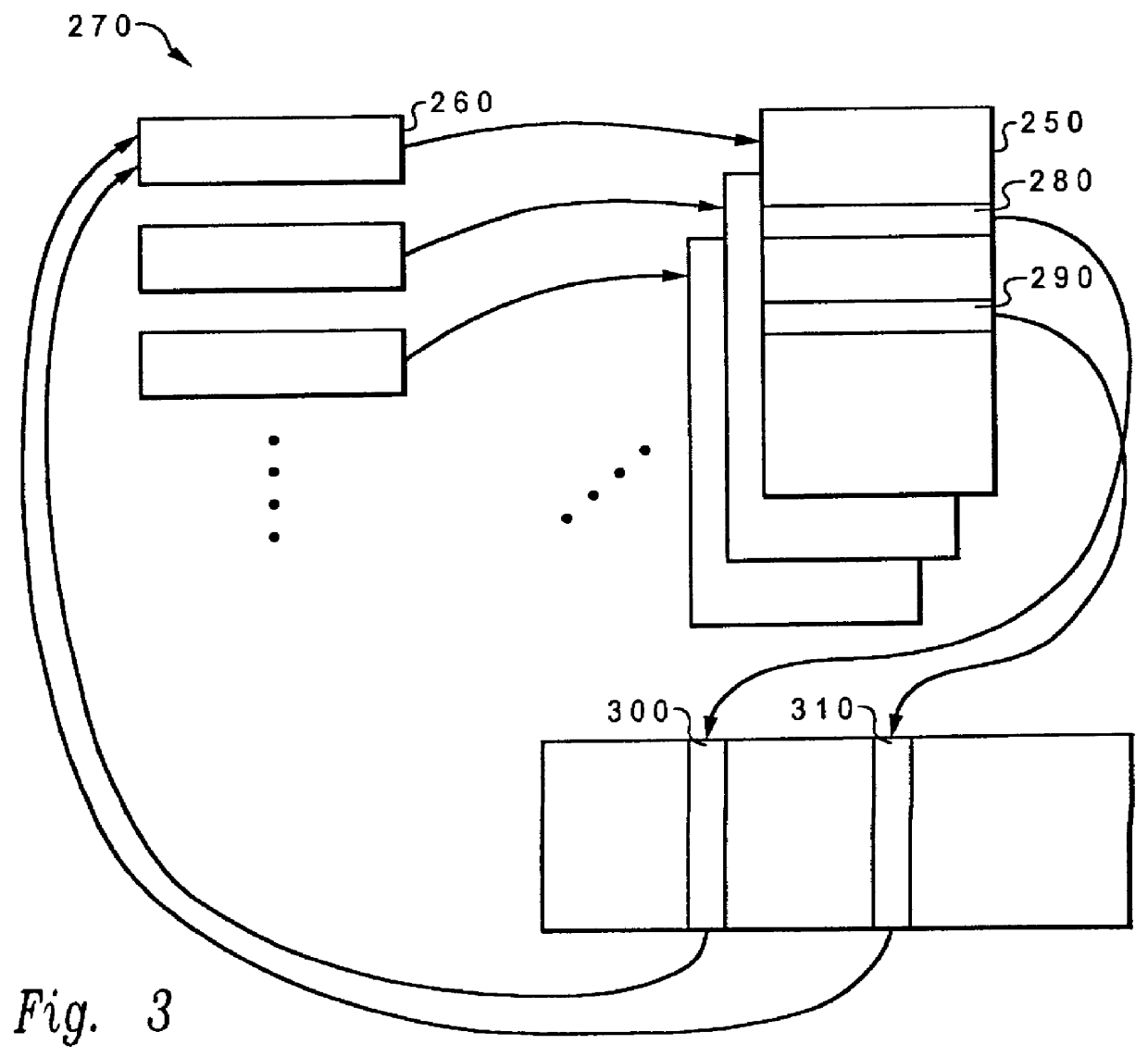

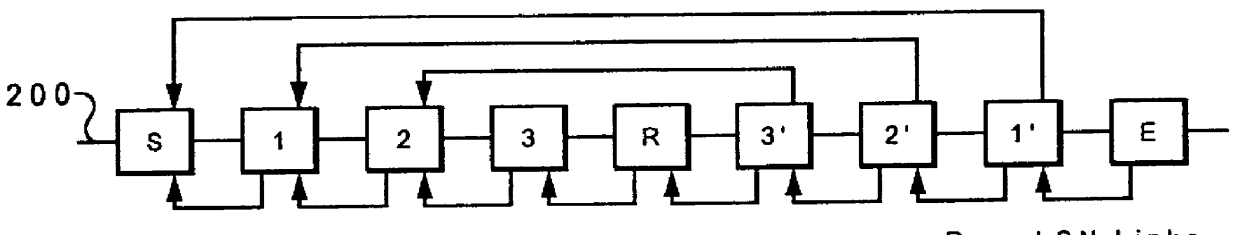

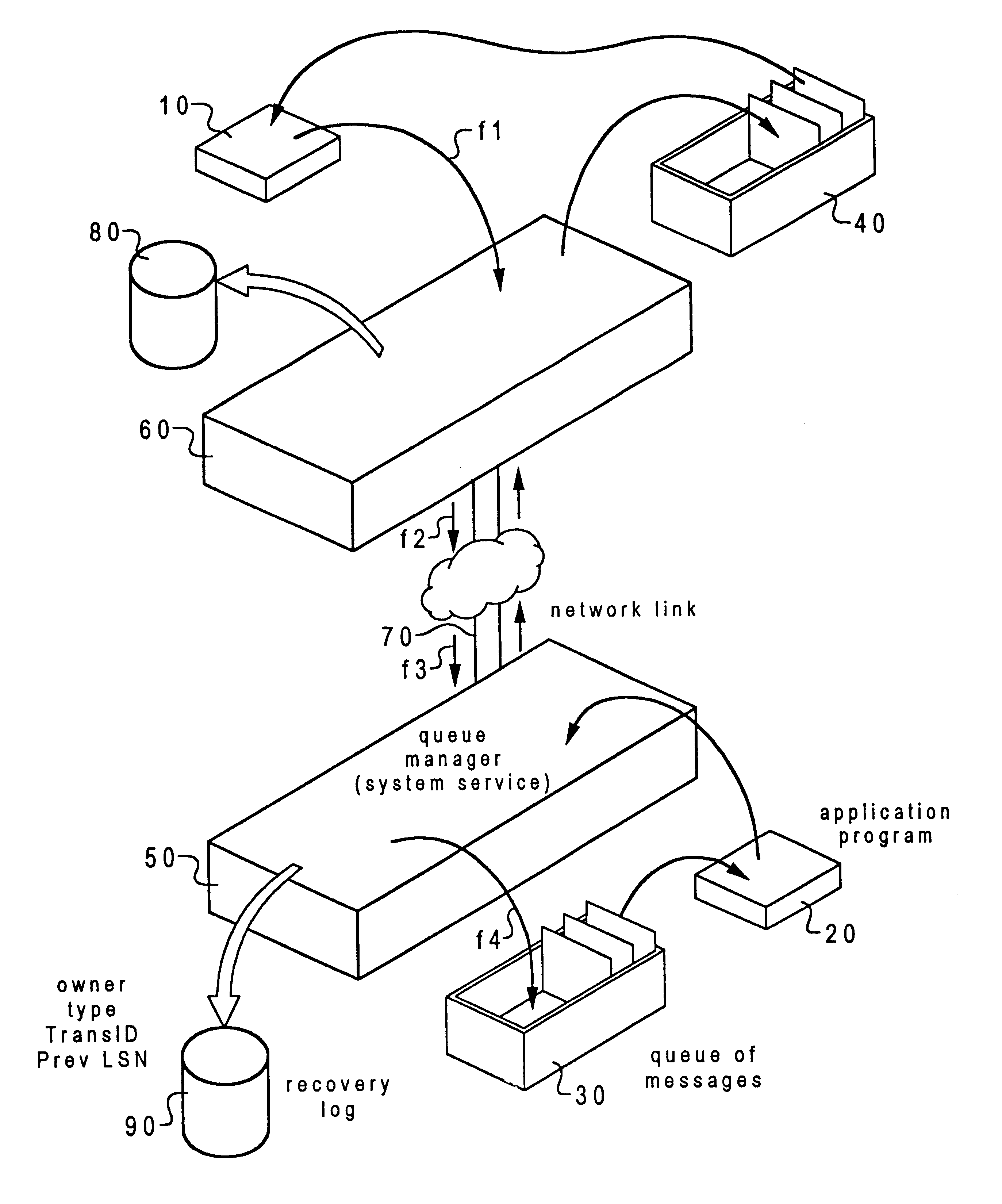

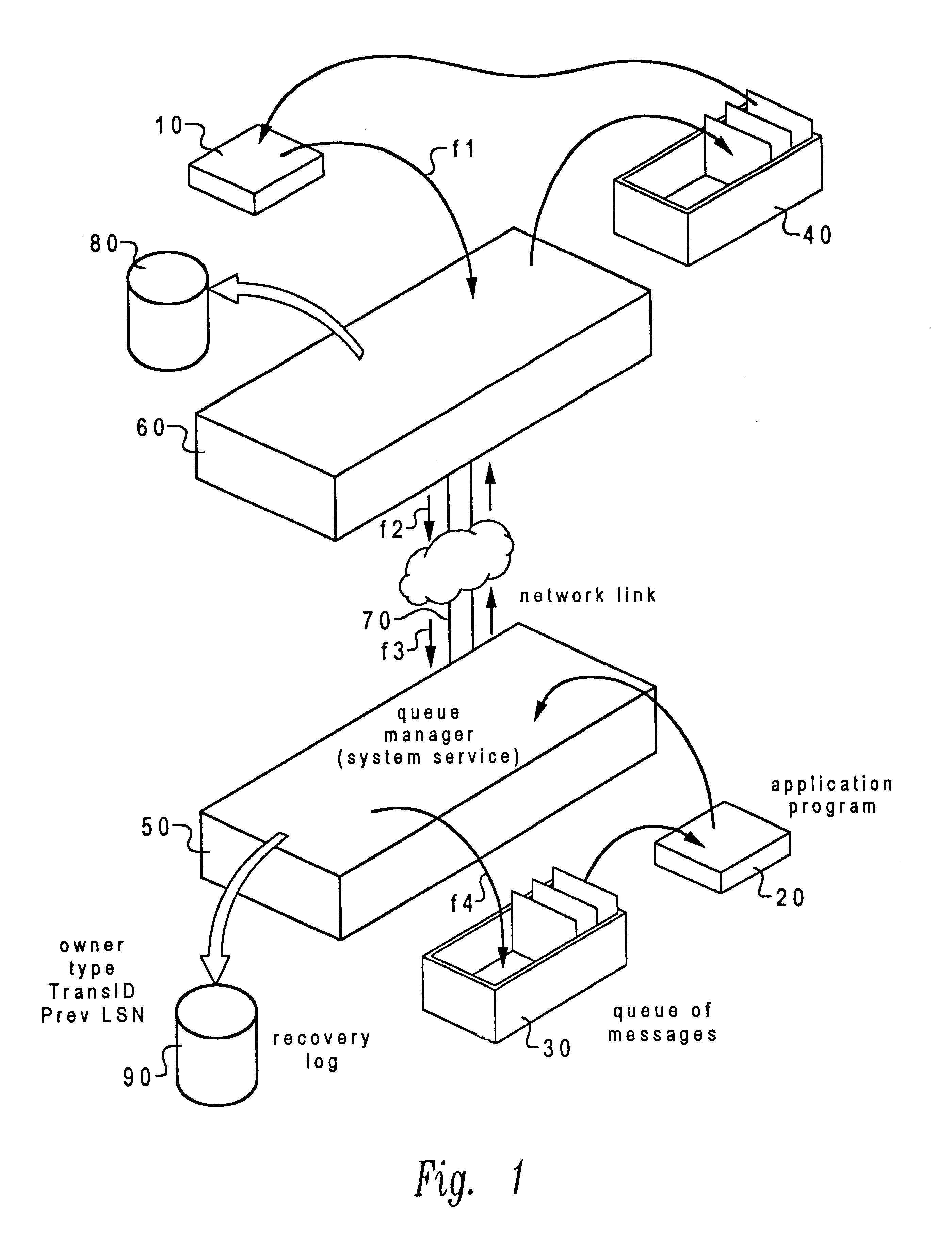

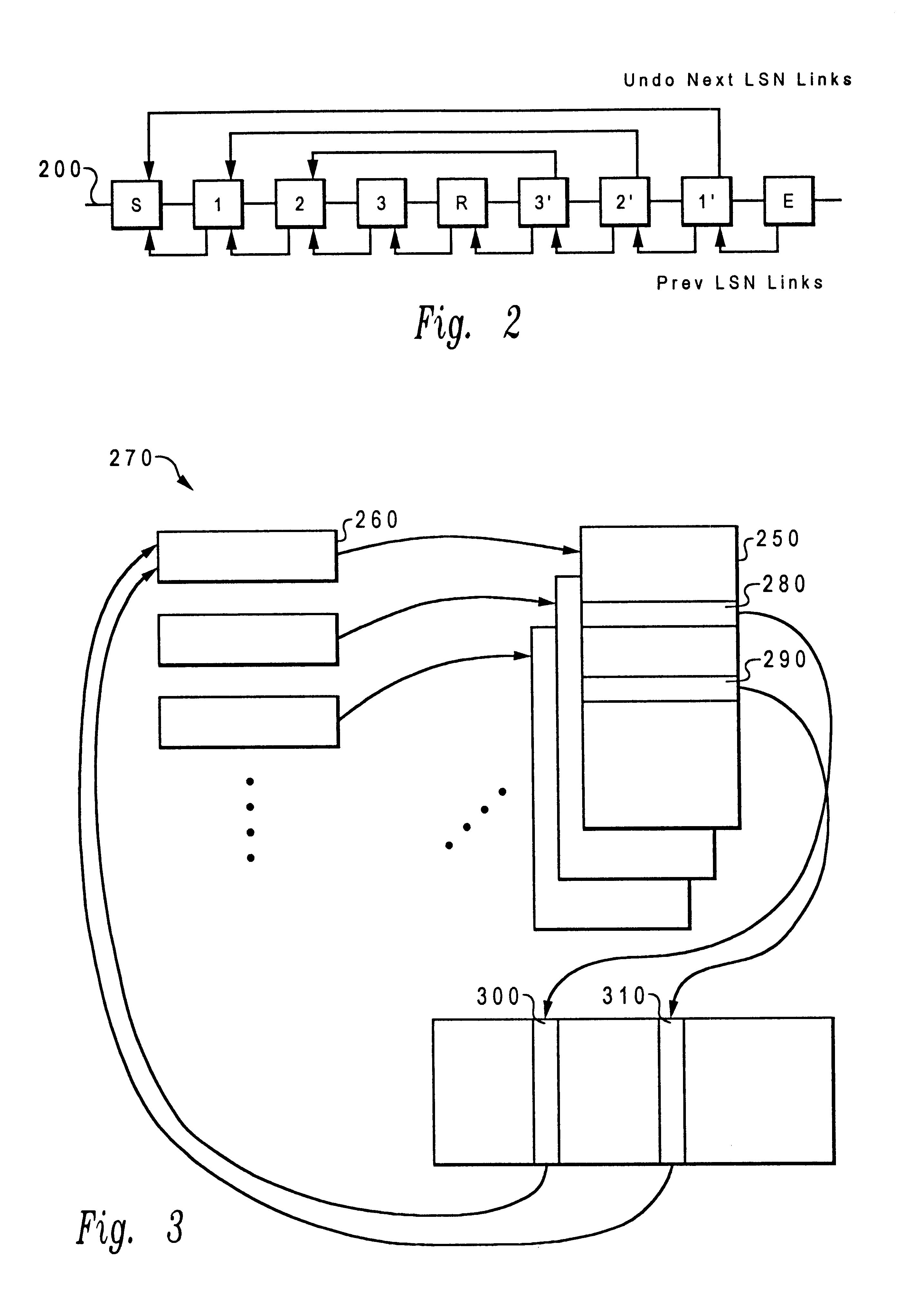

Method and system for performing resource updates and recovering operational records within a fault-tolerant transaction-oriented data processing system

InactiveUS6154847AData processing applicationsEmergency protective arrangements for automatic disconnectionData processing systemLow speed

A fault-tolerant transaction processing system and method stores records associated with operations of the system in order to permit recovery in the event of a need to roll back a transaction or to restart the system. At least some of the operational records are stored as a recovery log in low-speed non-volatile storage and at least some are stored as a recovery list in high speed volatile storage. Rollback of an individual transaction is effected by reference to the recovery list whereas restart of the system is effected by reference to the recovery log.

Owner:IBM CORP

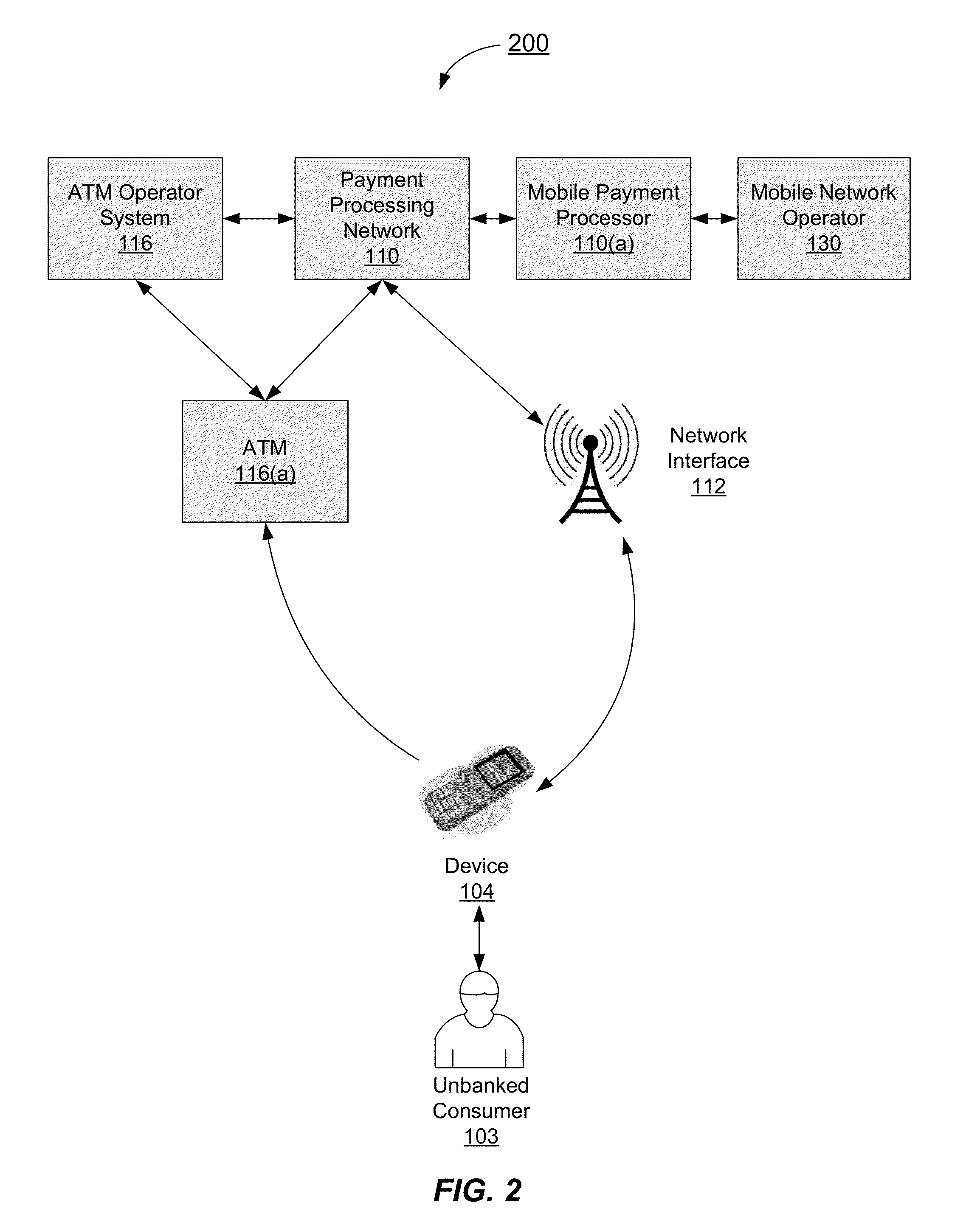

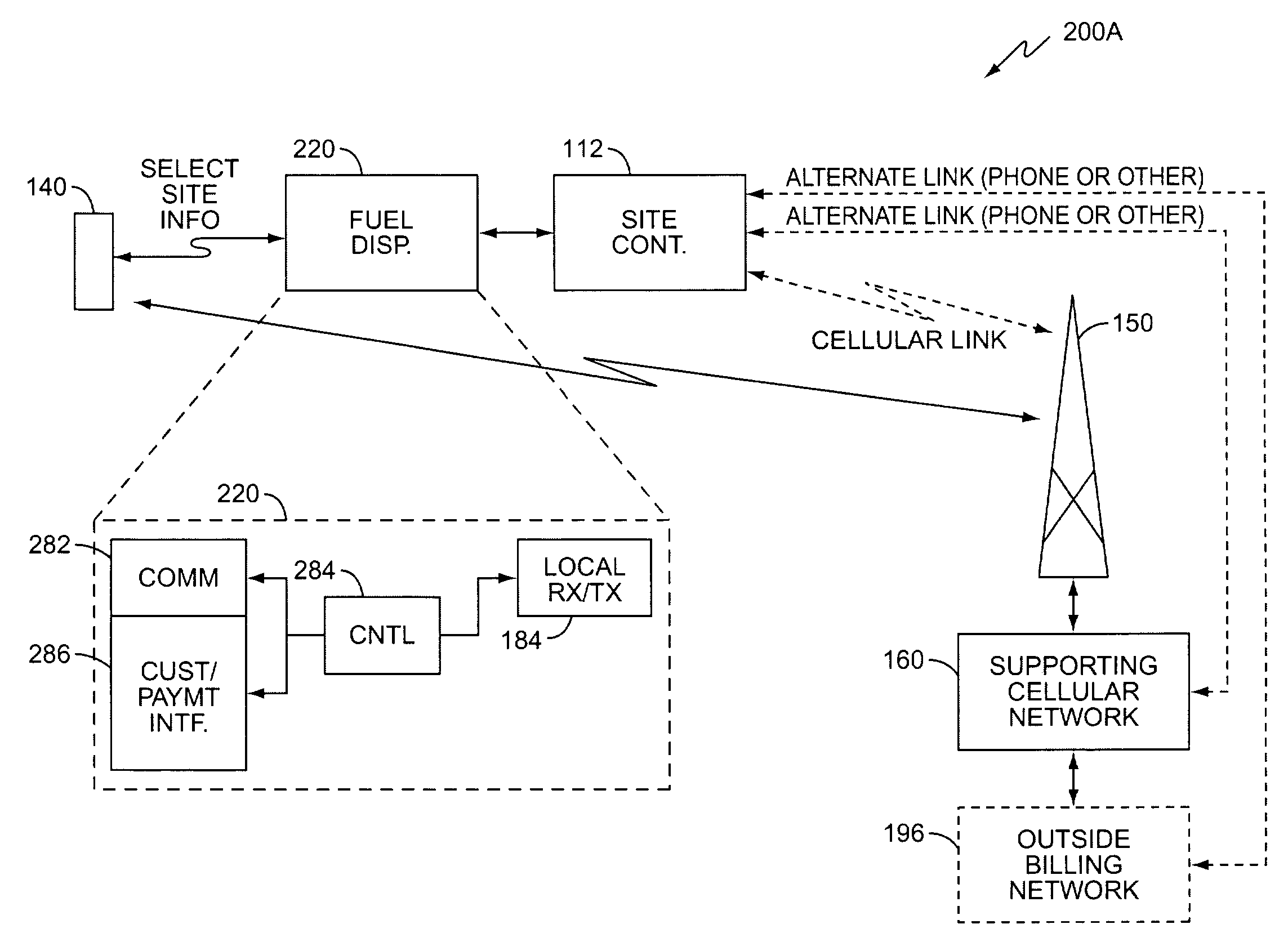

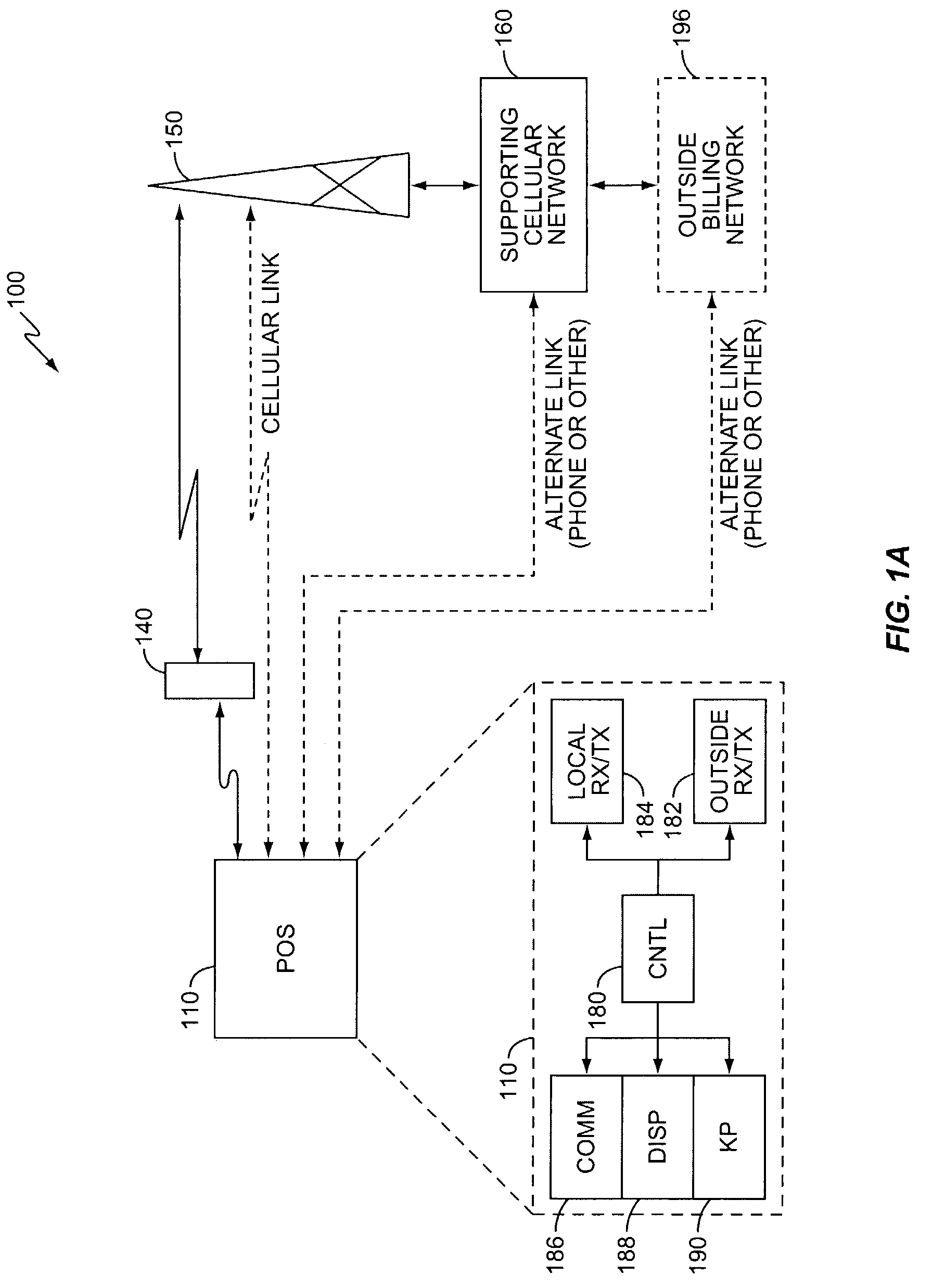

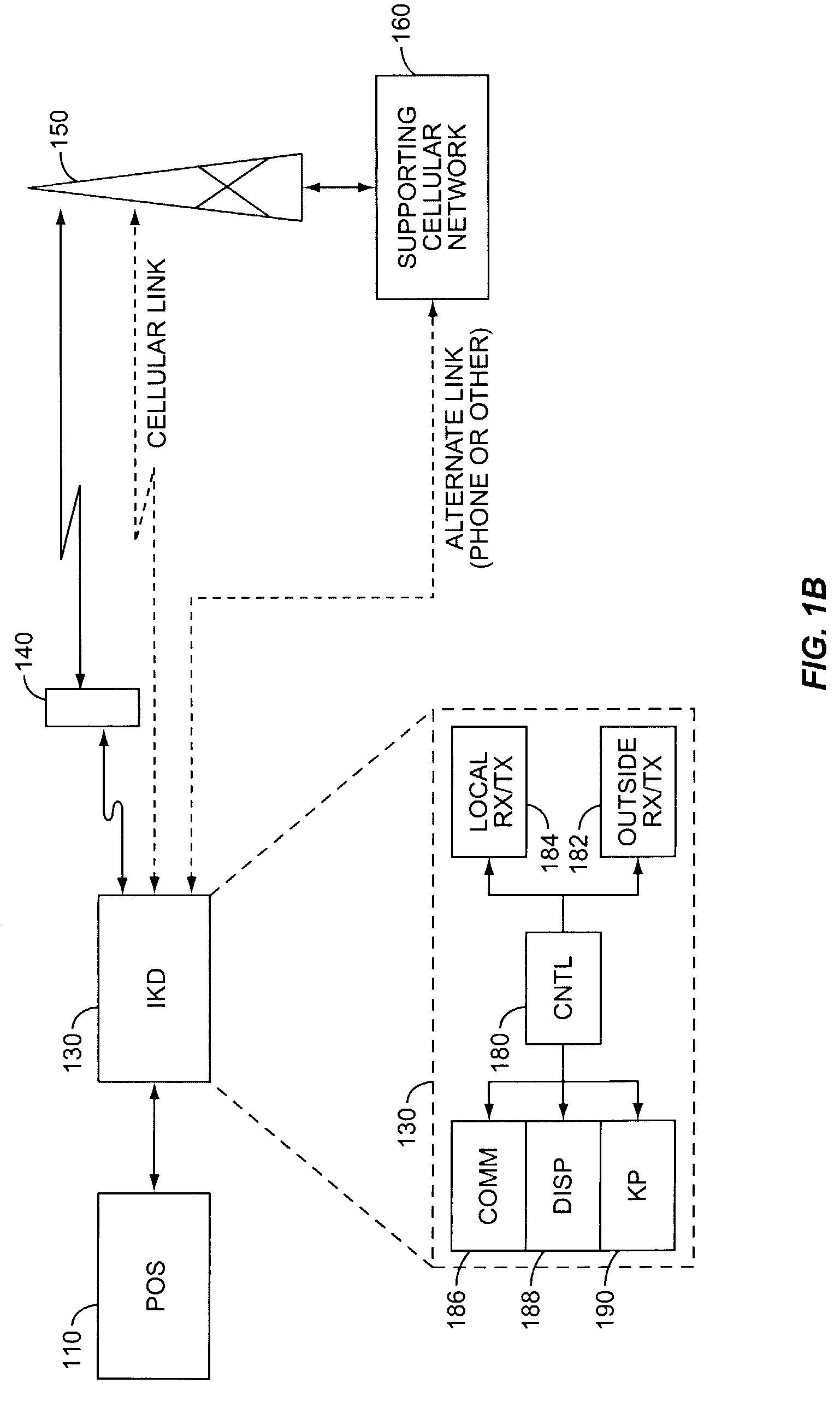

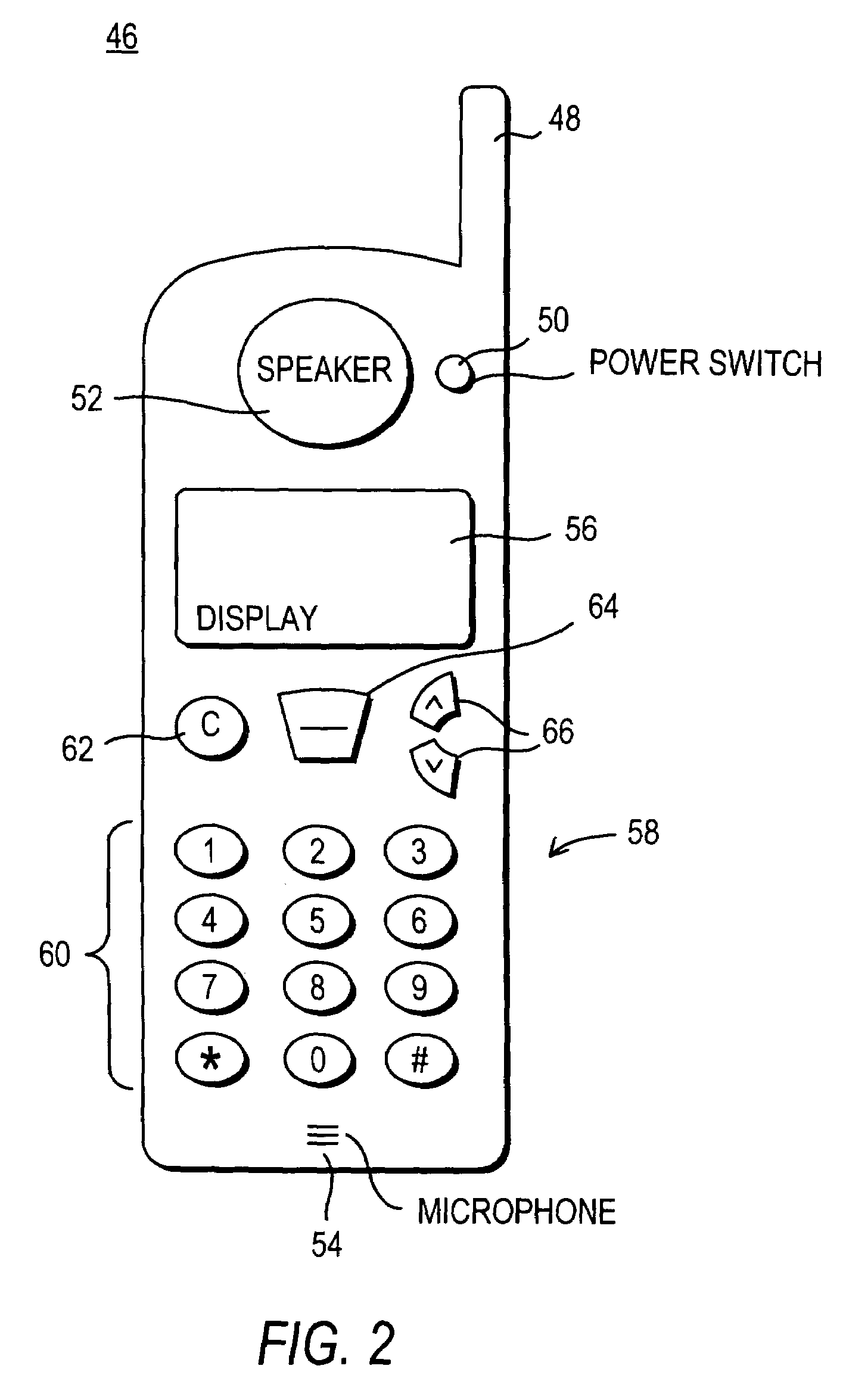

Cellular telephone-based transaction processing

InactiveUS7039389B2Telephonic communicationCredit schemesTelecommunications linkFinancial transaction

A retail transaction system provides enhanced customer convenience and increased transaction security by sending transaction information to a cellular network provider via a customer's digital cellular phone. For example, a fuel dispenser is equipped with a communications link allowing direct communications to a customer's cellular phone. When a customer desires to conduct a transaction using the fuel dispenser, the fuel dispenser transmits select information to the customer's cellular telephone using this communications link. A telephone number is included in the select information. When the customer presses send, or otherwise causes their telephone to dial the number transferred from the fuel dispenser, the select information along with any additional customer information is sent to the cellular network. This information is used by the network to authorize a purchase transaction for the customer, such authorization information returned to the fueling station at which the fuel dispenser is located via a cellular link. For enhanced security, the customer may be required to input their PIN in order to complete the transaction. Notably, the PIN and the remainder of the transaction information sent from the customer phone to the cellular network is intrinsically secure due to the digital encryption employed by the digital cellular protocol. Optionally, the system may be configured to cause the customer's cellular phone to automatically dial the number transferred by the fuel dispenser. This capability may be enabled at the customer's option. The system may be extended to other retail systems including in-store point-of-sale systems (POS).

Owner:GILBARCO

Secure magnetic stripe reader for handheld computing and method of using same

ActiveUS7309012B2Limited useful battery lifeLow costAcutation objectsFinanceInformation processingSoftware system

A secure magnetic stripe card stripe reader (MSR) module and software system capable of encrypting the magnetic stripe data to CISP standards for use in point of sale (POS) and other applications requiring data security using non secure networks and computing devices. Additionally, when incorporated within an attachment for conventional personal digital assistant (PDA) or cell phone or stationary terminal, provides encrypted data from the magnetic head assembly providing compliance with Federal Information Processing Standards Publication Series FIPS 140 covering security and tampering standards. Moreover, this module and software system includes the capability of providing secure POS transactions to legacy transaction processing systems transparently to the existing infrastructure. Furthermore, this module and software system includes the capability of transparently providing detection of fraudulently copied magnetic stripe cards.

Owner:VERIFONE INC

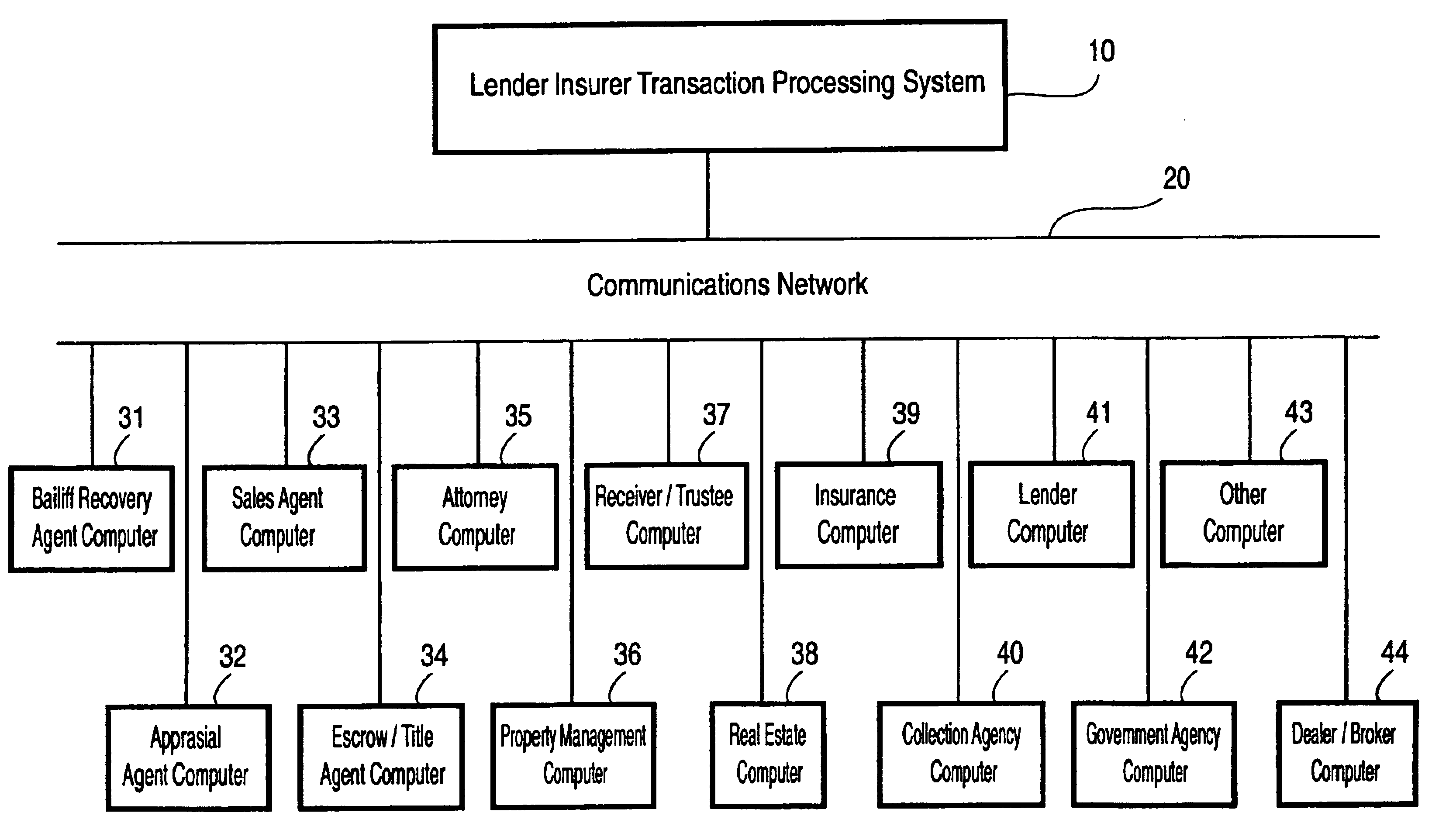

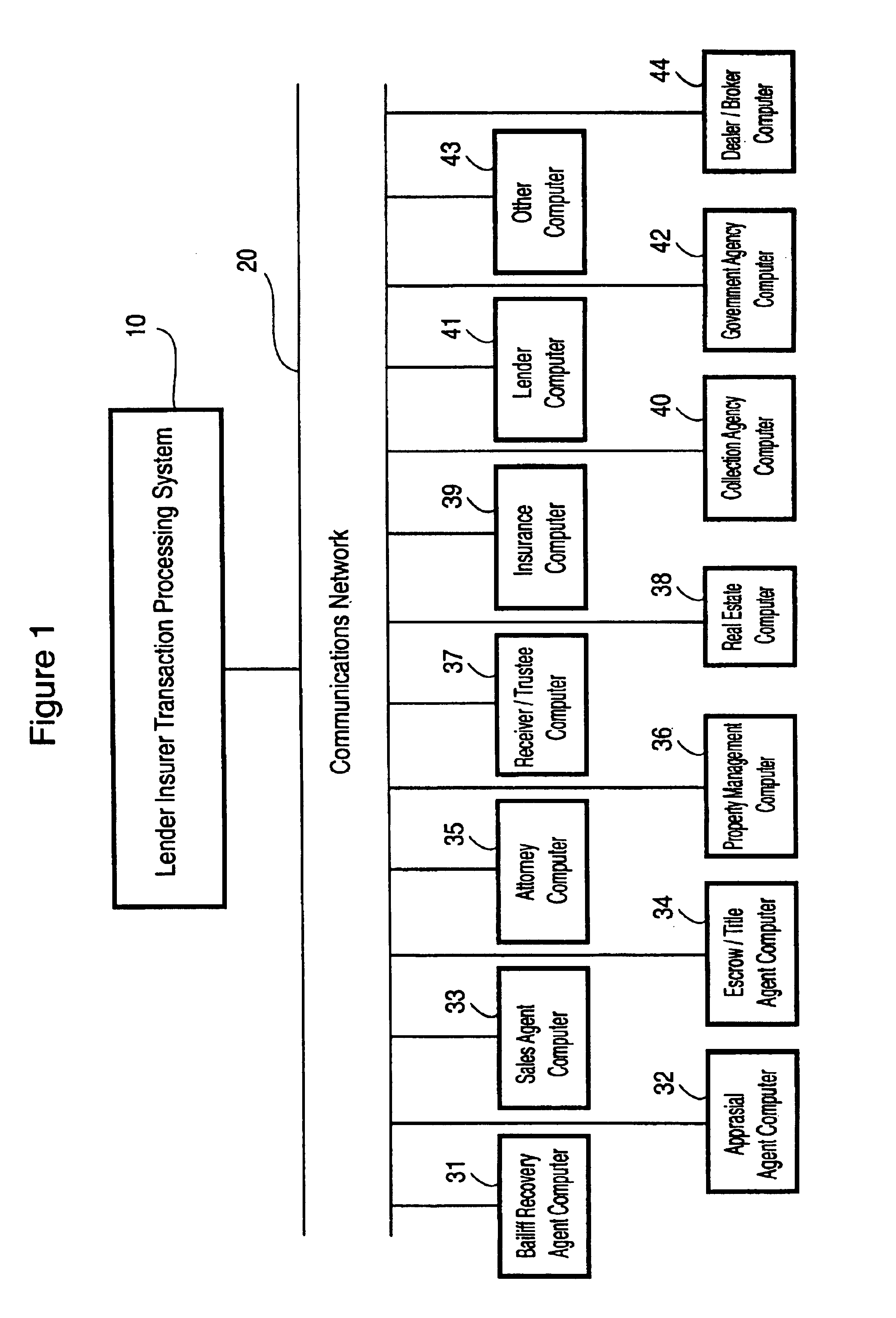

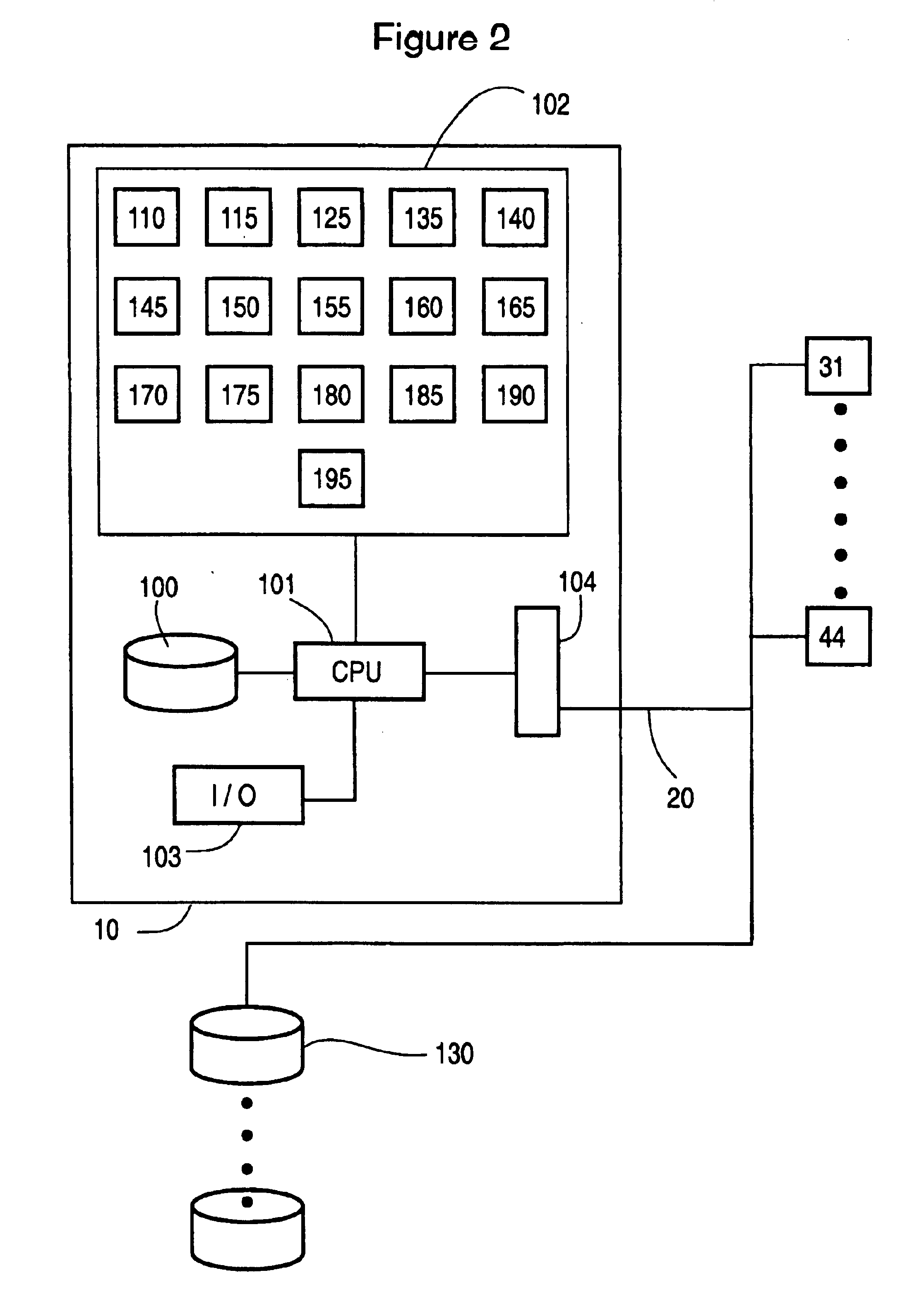

Lender and insurer transaction processing system and method

A system and method for transaction processing includes a central repository of transaction information which can be accessed by a variety of participants who may be located over a wide geographic area in the recovery process of a property unit such as a vehicle or other collateral. Interfacing with a variety of computer systems over a communication network, such as the Internet, allows interchange of data relating to the recovery process and centralized coordination of the recovery process.

Owner:DH COLLATERAL MANAGEMENT CORP

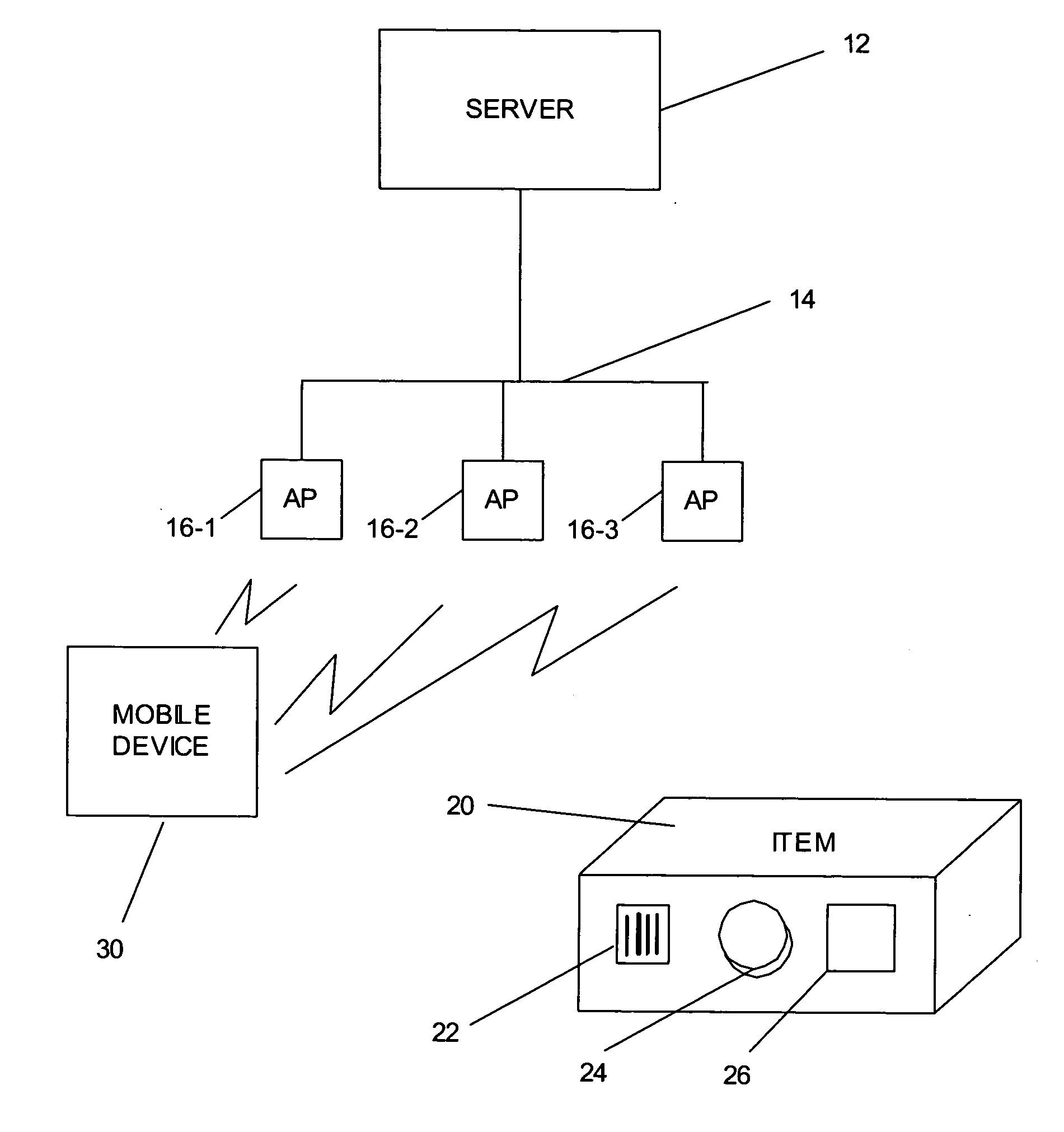

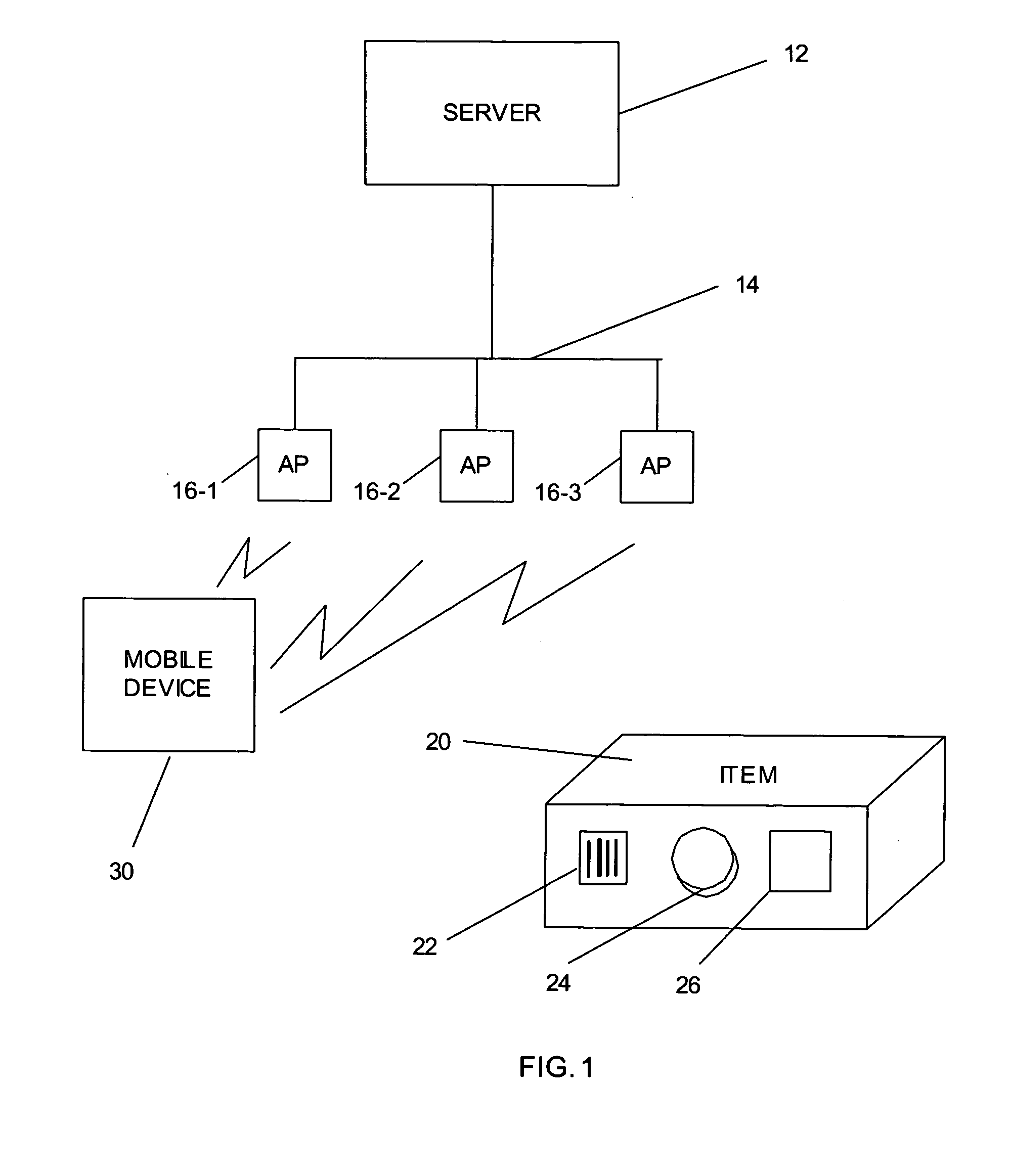

System and method for providing location information in transaction processing

ActiveUS20050242188A1Co-operative working arrangementsCharacter and pattern recognitionBarcodeInformation device

Real time location system functionality is provided in conjunction with bar codes and other coded information devices to provide location information in transaction processing systems. A system and method of the present invention may be used to track the location of objects which are coupled to coded information devices.

Owner:SYMBOL TECH LLC

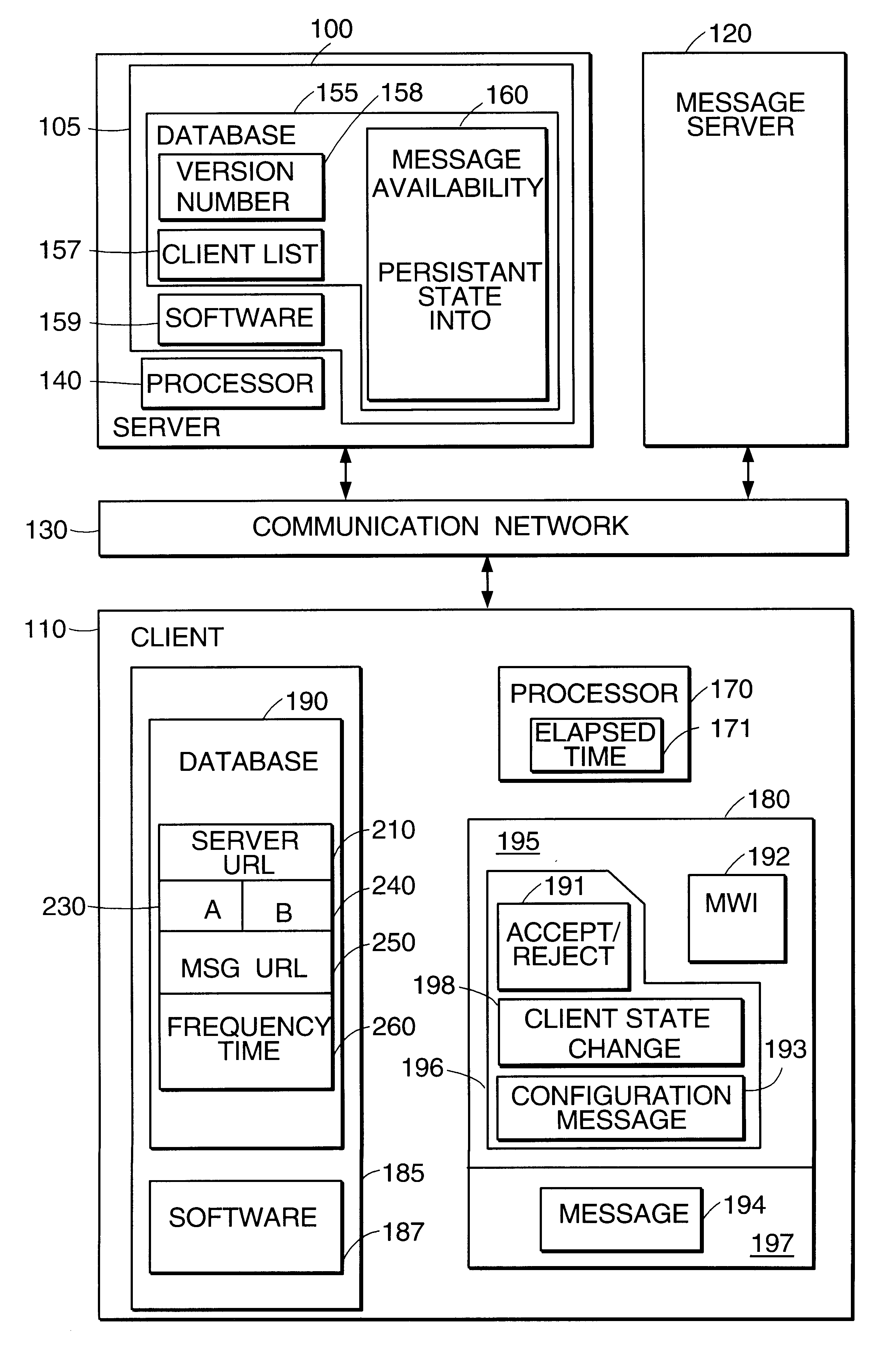

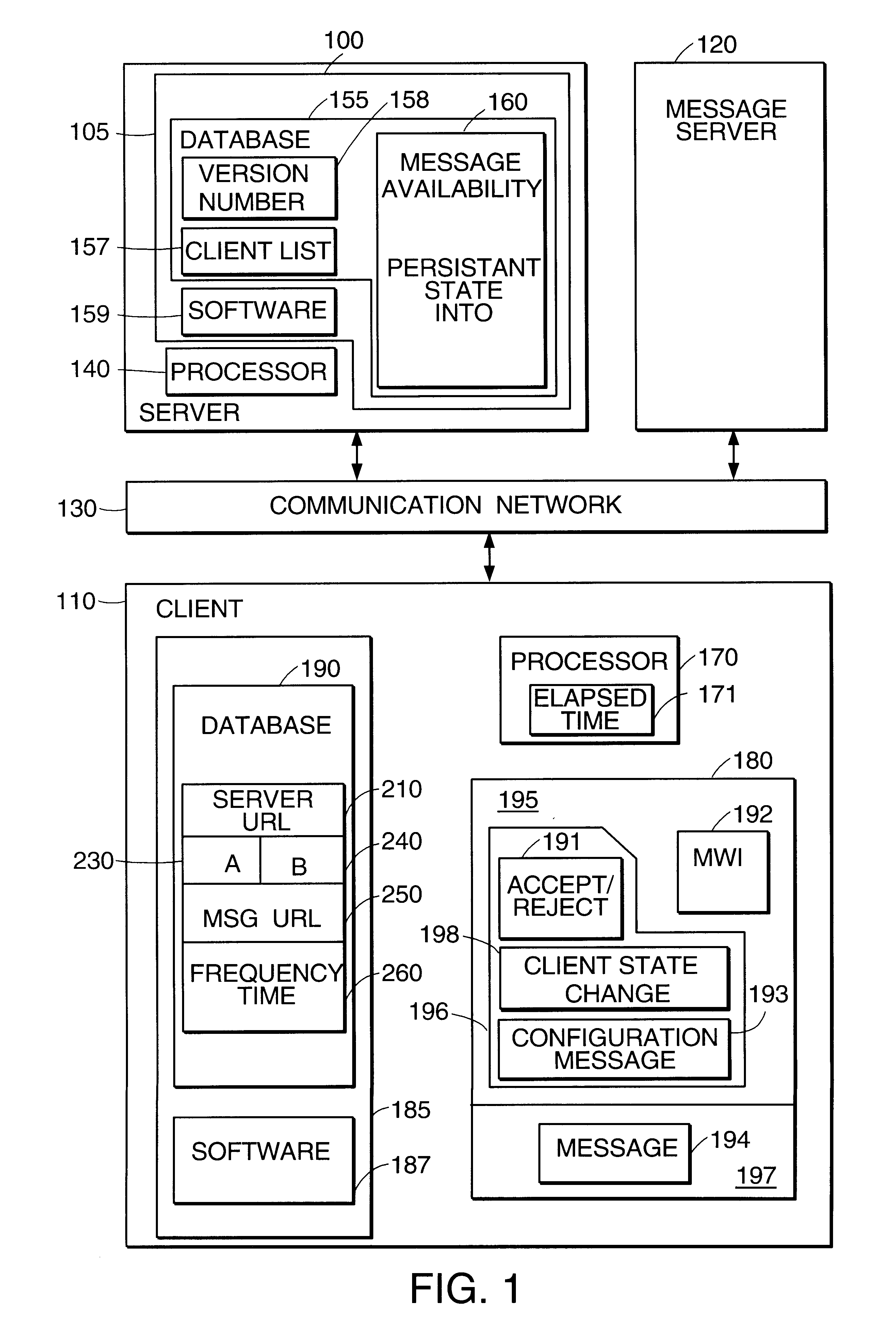

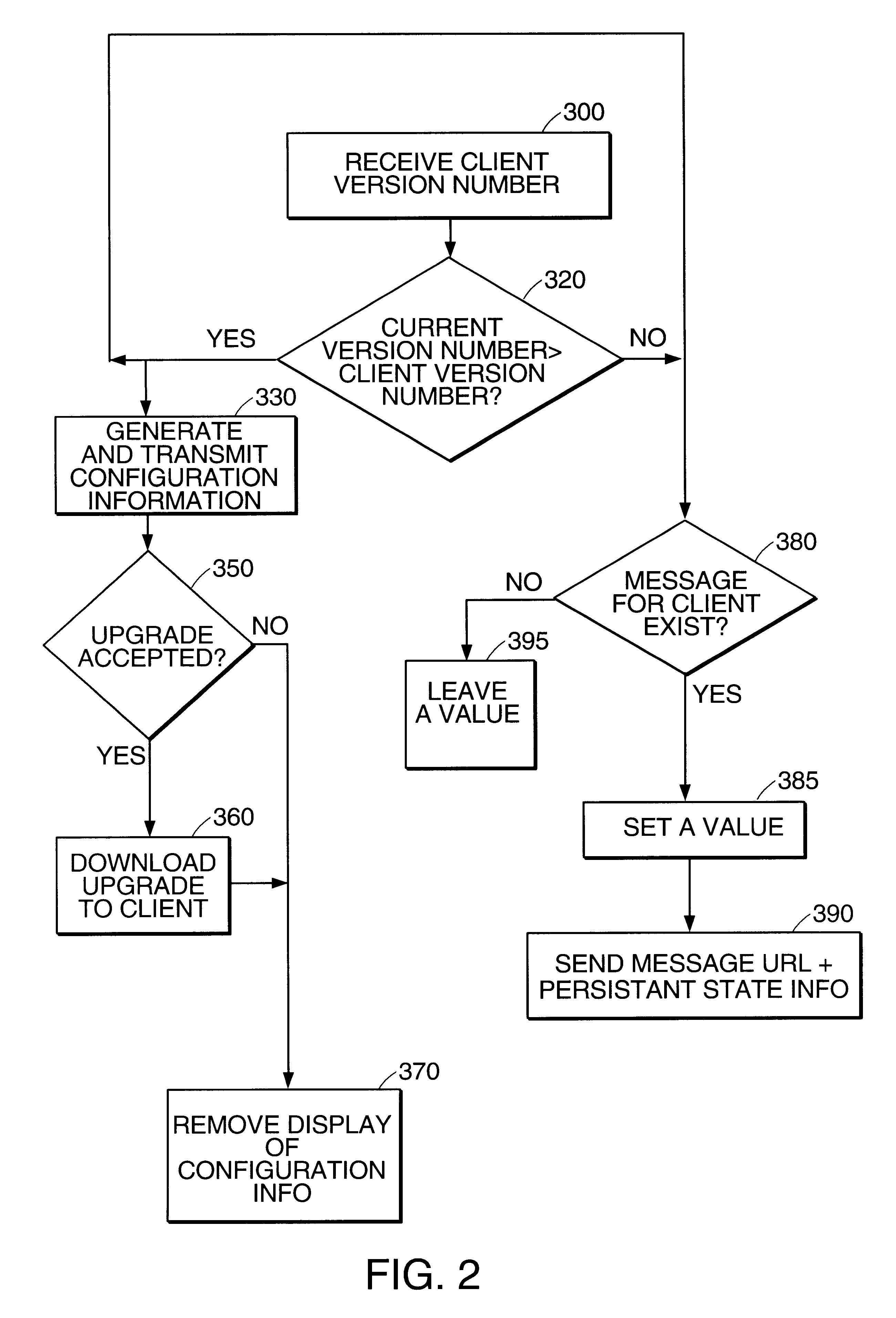

Configuring client software using remote notification

InactiveUS6219698B1New informationEasy to installProgram control using stored programsDigital computer detailsClient-sideHandling system

To maintain communications between first and second processing systems interconnected by a communications network, computer programing having first and second sets of instructions are stored at the first processing system. The computer programing is initialized at the first processing system to perform a task associated with the first set of instructions. In accordance with the second set of instructions, a first signal is automatically transmitted from the first processing system to the second processing system responsive to the initialization of the computer programming.

Owner:GOOGLE LLC

Financial transaction processing system and method

InactiveUS6302326B1Easy to develop and modifyEasy to changeComplete banking machinesHand manipulated computer devicesRelational databaseFinancial transaction

A financial transaction processing system (10) enables processing transactions from various types of card activated terminal devices (12) which communicate using a variety of electronic message formats. The transaction processing system includes among its software components message gateway routers (MGRs) (24, 164) which operate using information stored in the relational database to convert messages from a variety of external message formats used by the external devices and authorization systems, to a common internal message format used within the system. The system further uses database information to internally route messages to message processing programs (MPPs) (108, 138) which process messages and generate messages to the external devices and authorization systems. The MGR also converts the outgoing messages from the internal message format to the external message formats which can be interpreted by the external devices and systems to which the messages are directed.

Owner:DIEBOLD NIXDORF

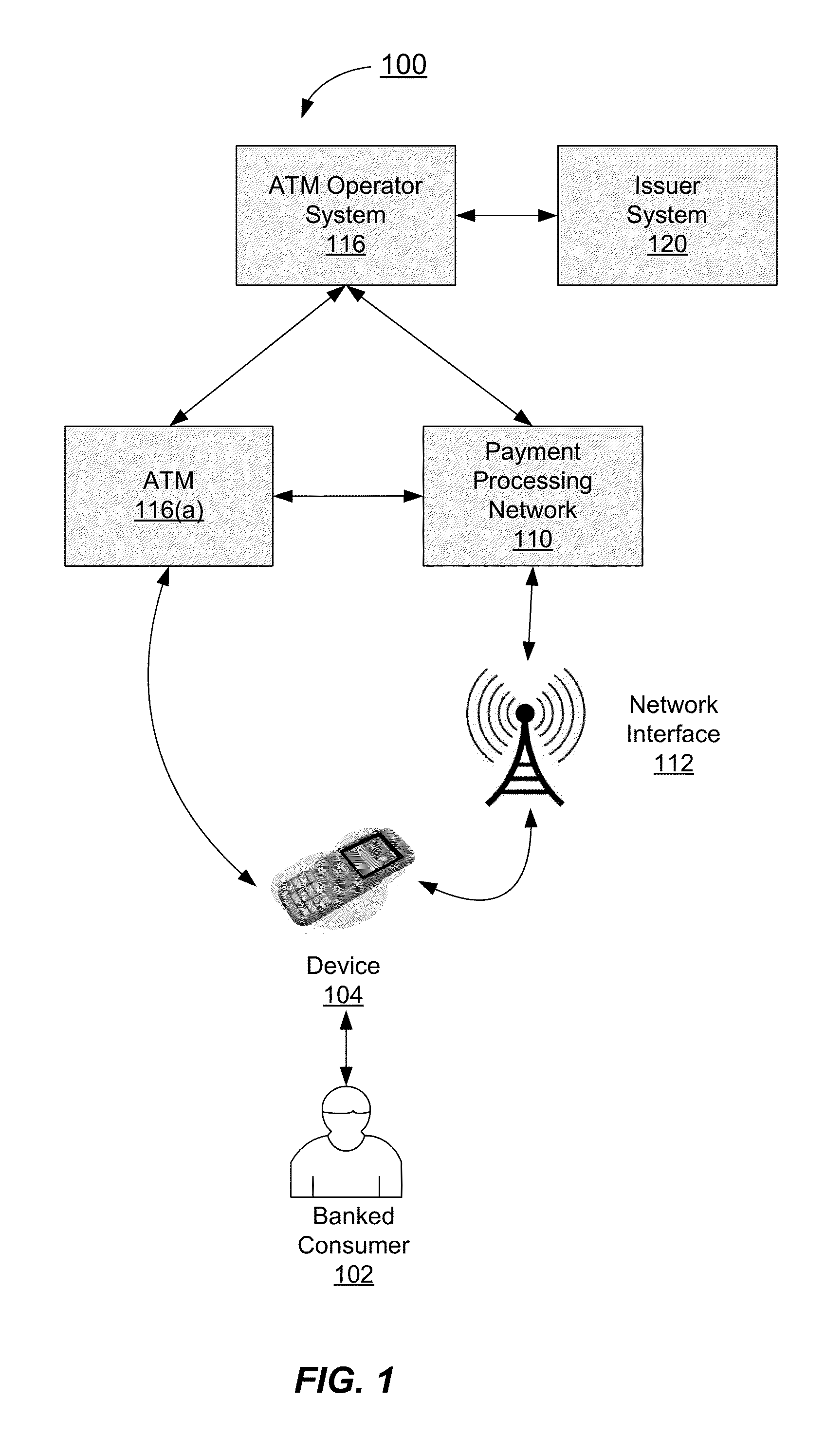

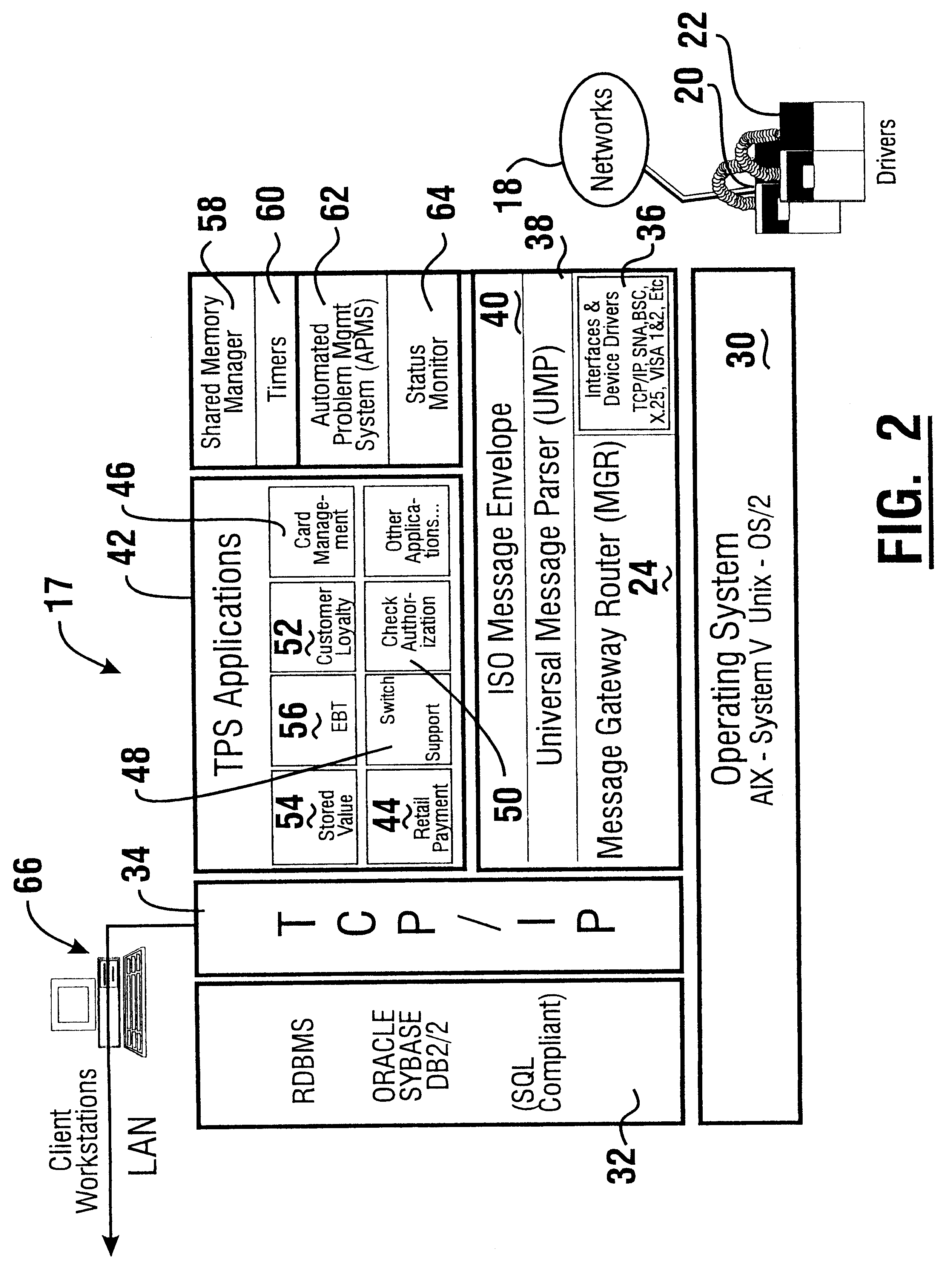

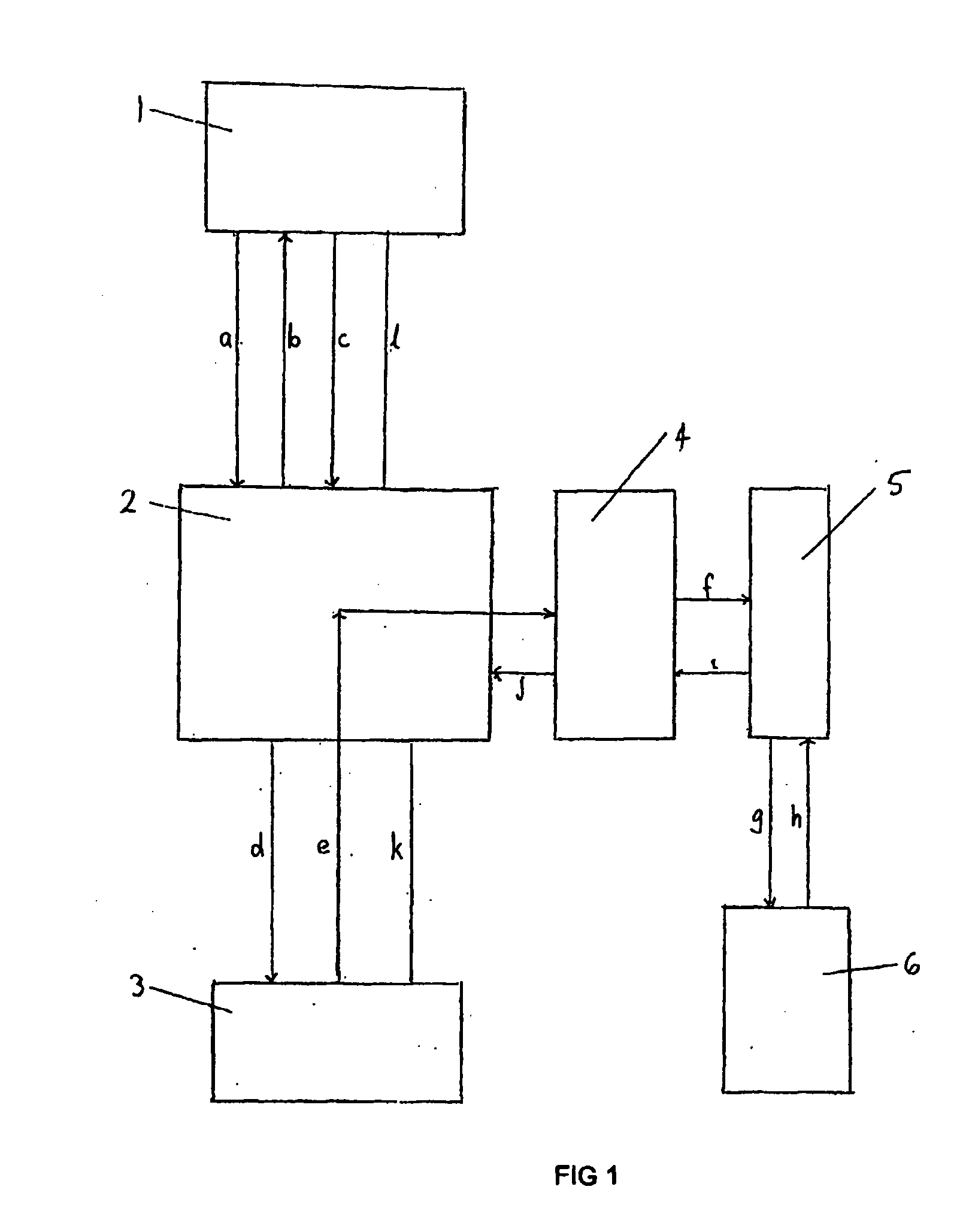

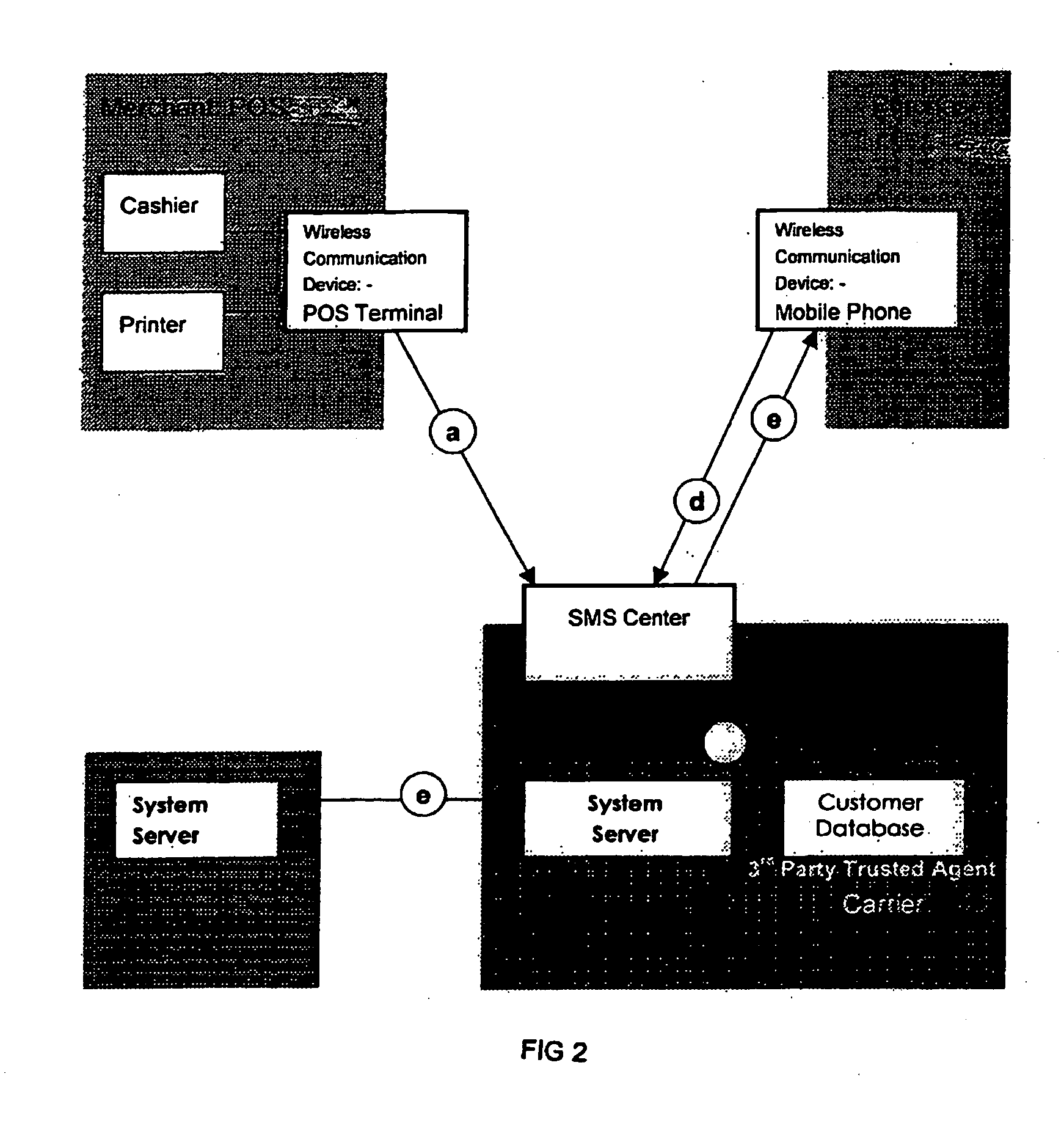

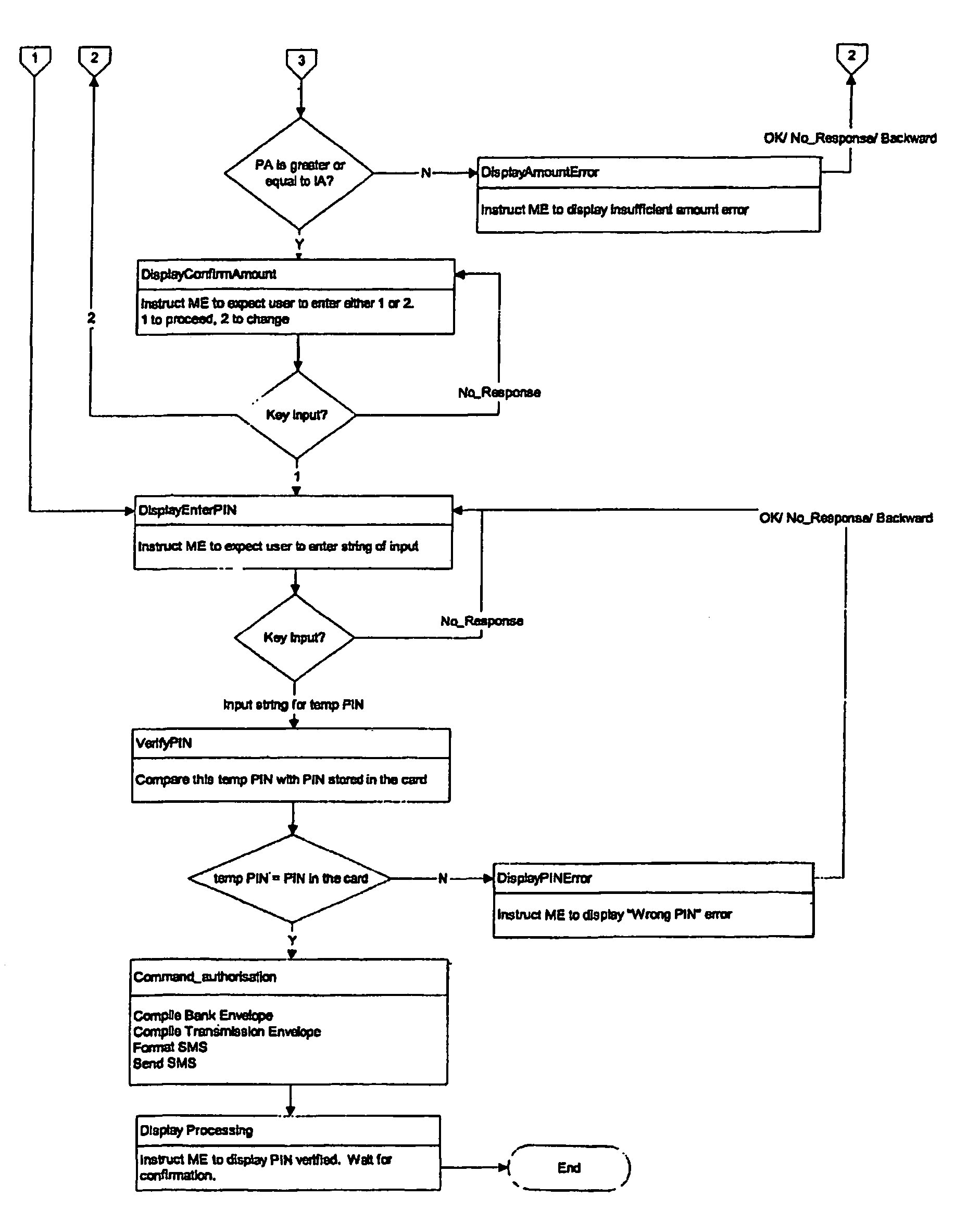

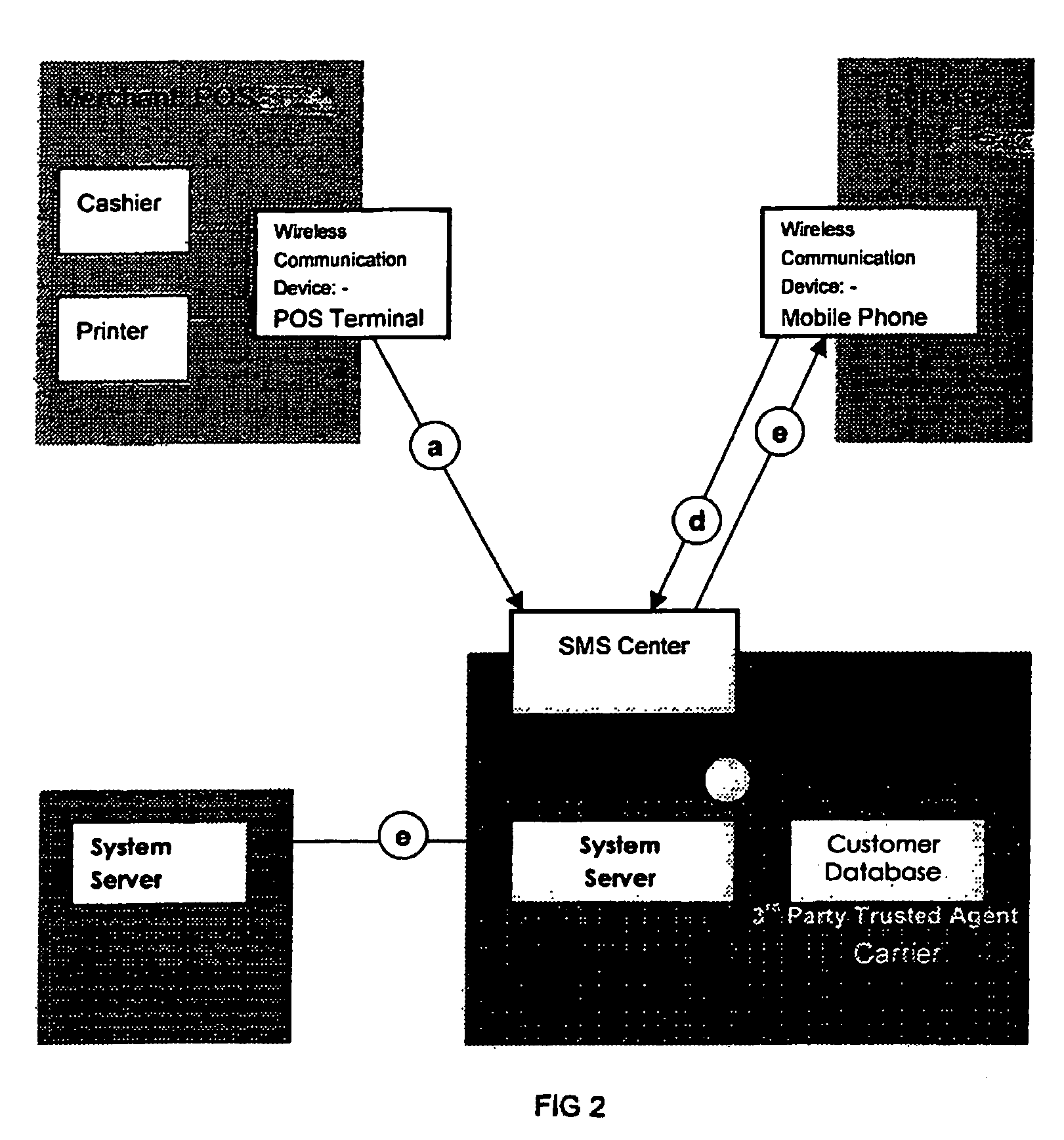

System and method for facilitating electronic financial transactions using a mobile telecommunication device

InactiveUS20050177517A1Improve securityFurther level of securityAccounting/billing servicesUser identity/authority verificationPaymentComputer module

A transaction processing system for processing a transaction between a supplier and a customer, said system comprising a supplier device for initiating the transaction, a system server and a mobile communication device, said device containing a message processing program module for enabling local verification of the transaction within the mobile device, wherein a transaction message is sent from the supplier device to the system server, a message requesting payment for the transaction is sent from the system server to the mobile communication device, the transaction is authorised and verified at the mobile telecommunications device from which a verification message is sent back to the system server, and the transaction is then processed.

Owner:LEUNG GARY +7

Systems and methods for providing a RF transaction device for use in a private label transaction

InactiveUS7119659B2Reduce needImage analysisDigital data processing detailsTransaction processing systemDatabase

A RF transaction device is provided, which is operable to store a private label transaction account identifier associated with a private label transaction account. The invention further includes a RF operable reader in communication with a private label transaction processing system. The RF transaction device communicates with the reader to provide the private label transaction account identifier to the transaction processing system. As such, the invention provides a RF transaction device which may be used to complete a transaction using RF frequency in a contactless environment.

Owner:LIBERTY PEAK VENTURES LLC +1

System and method for facilitating electronic financial transactions using a mobile telecommunication device

InactiveUS7379920B2Improve securityFurther level of securityAccounting/billing servicesUser identity/authority verificationPaymentComputer module

A transaction processing system for processing a transaction between a supplier and a customer, said system comprising a supplier device for initiating the transaction, a system server and a mobile communication device, said device containing a message processing program module for enabling local verification of the transaction within the mobile device, wherein a transaction message is sent from the supplier device to the system server, a message requesting payment for the transaction is sent from the system server to the mobile communication device, the transaction is authorized and verified at the mobile telecommunications device from which a verification message is sent back to the system server, and the transaction is then processed.

Owner:LEUNG GARY +7

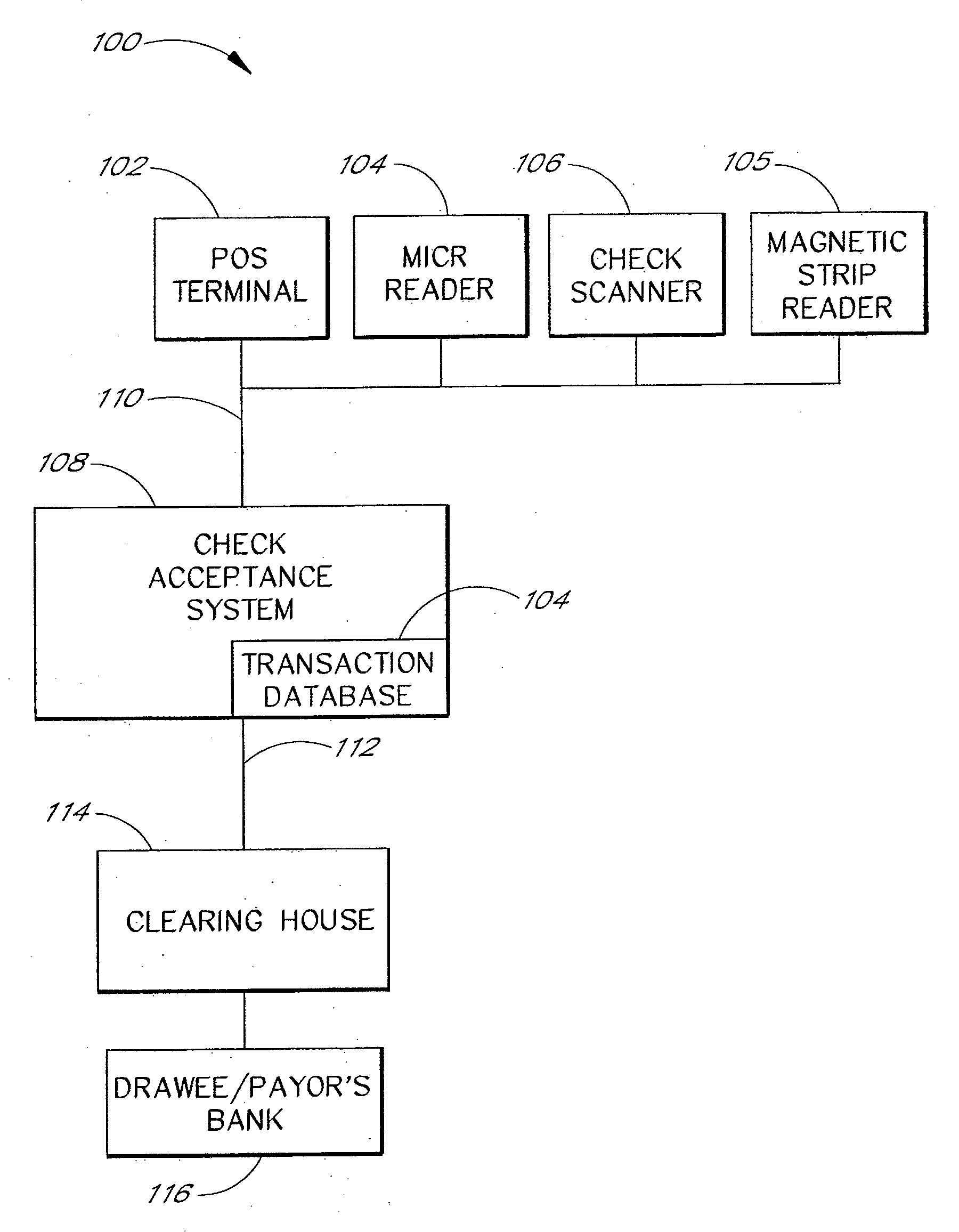

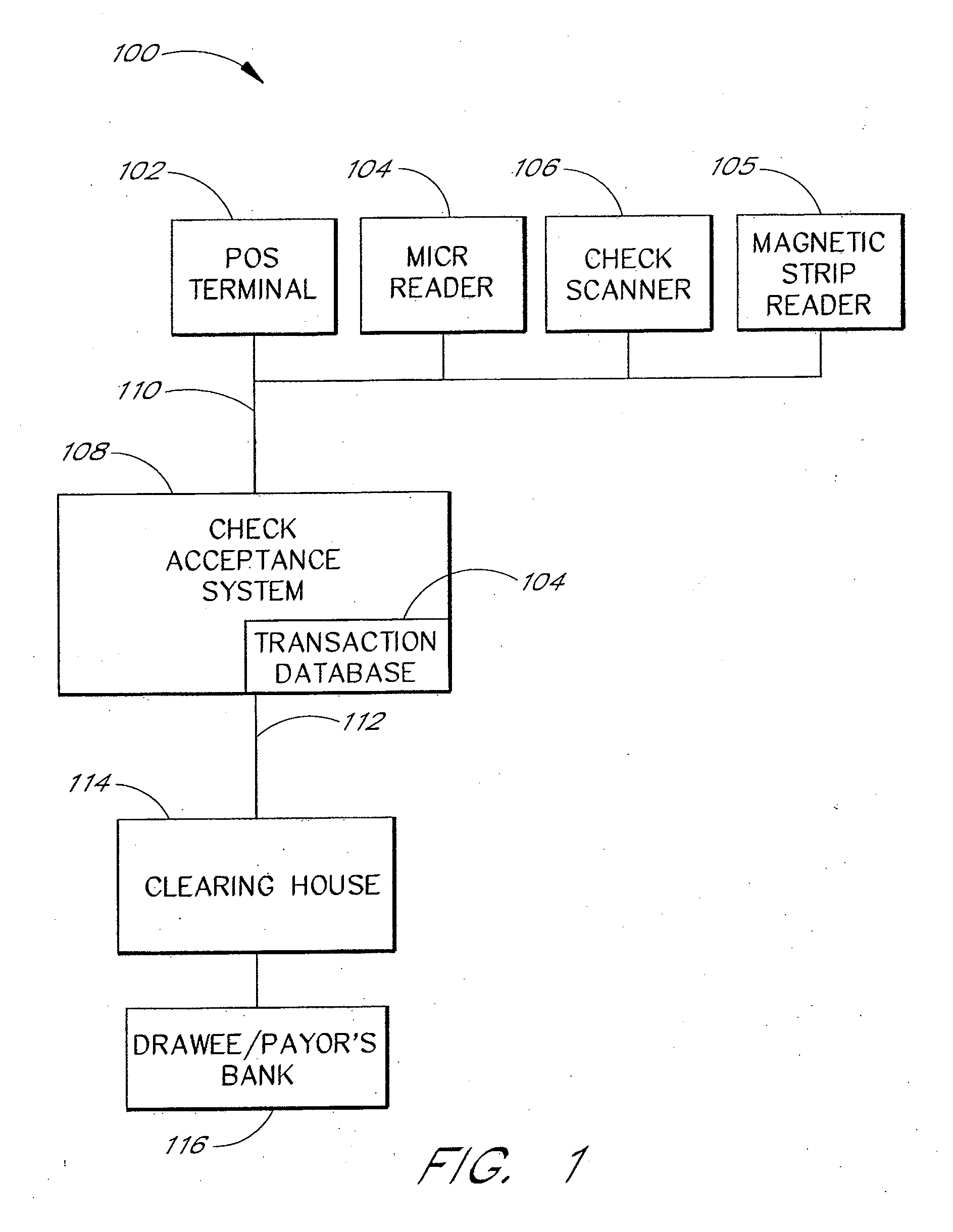

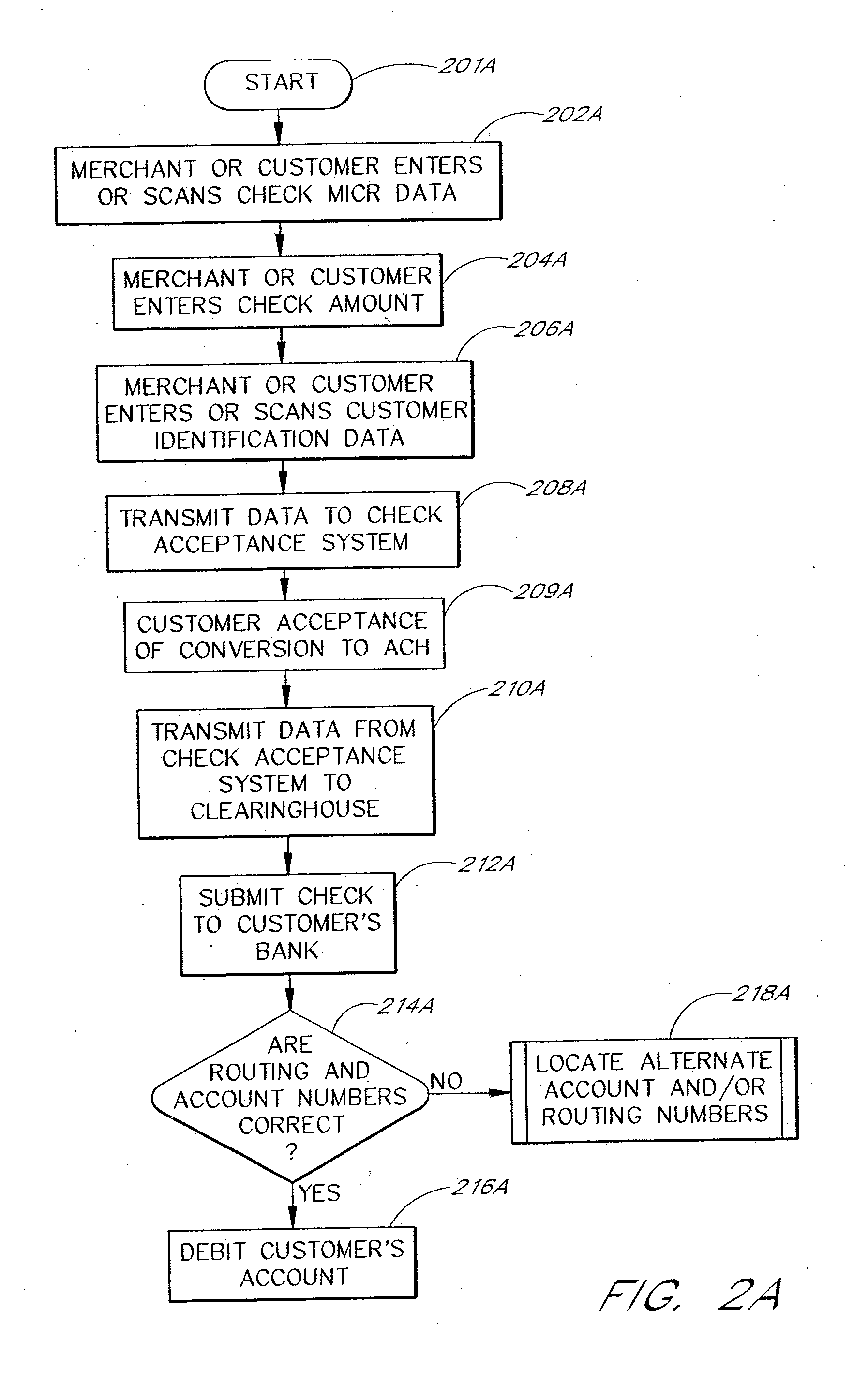

Apparatus and methods for processing misread or miskeyed magnetic indicia

The present invention is directed to methods and apparatus for processing check data, such as data stored using magnetic indicia. In one embodiment, a check transaction processing system receives an indication that a first check transaction from a first payor failed to clear because at least a portion of first MICR or other account data associated with the first check transaction is incorrect. The check transaction processing system reads a personal identifier associated with the first payor, wherein the personal identifier was provided in association with the first check transaction. MICR data or other account data associated with a previously processed check transaction associated with the personal identifier is located. At least a portion of the located MICR or other account data is compared with at least the portion of first MICR or other account data associated with the first check transaction, and based at least in part on the comparison, the check transaction processing system determines if the portion of the located data is at least a potentially correct version of the portion of first MICR or other account data.

Owner:FIRST DATA

Method and system for fault tolerant transaction-oriented data processing system

InactiveUS6493826B1Data processing applicationsMemory loss protectionData processing systemLow speed

A fault-tolerant transaction processing system and method stores records associated with operations of the system in order to permit recovery in the event of a need to roll back a transaction or to restart the system. At least some of the operational records are stored as a recovery log in low-speed non-volatile storage and at least some are stored as a recovery list in high speed volatile storage. Rollback of an individual transaction is effected by reference to the recovery list whereas restart of the system is effected by reference to the recovery log.

Owner:IBM CORP

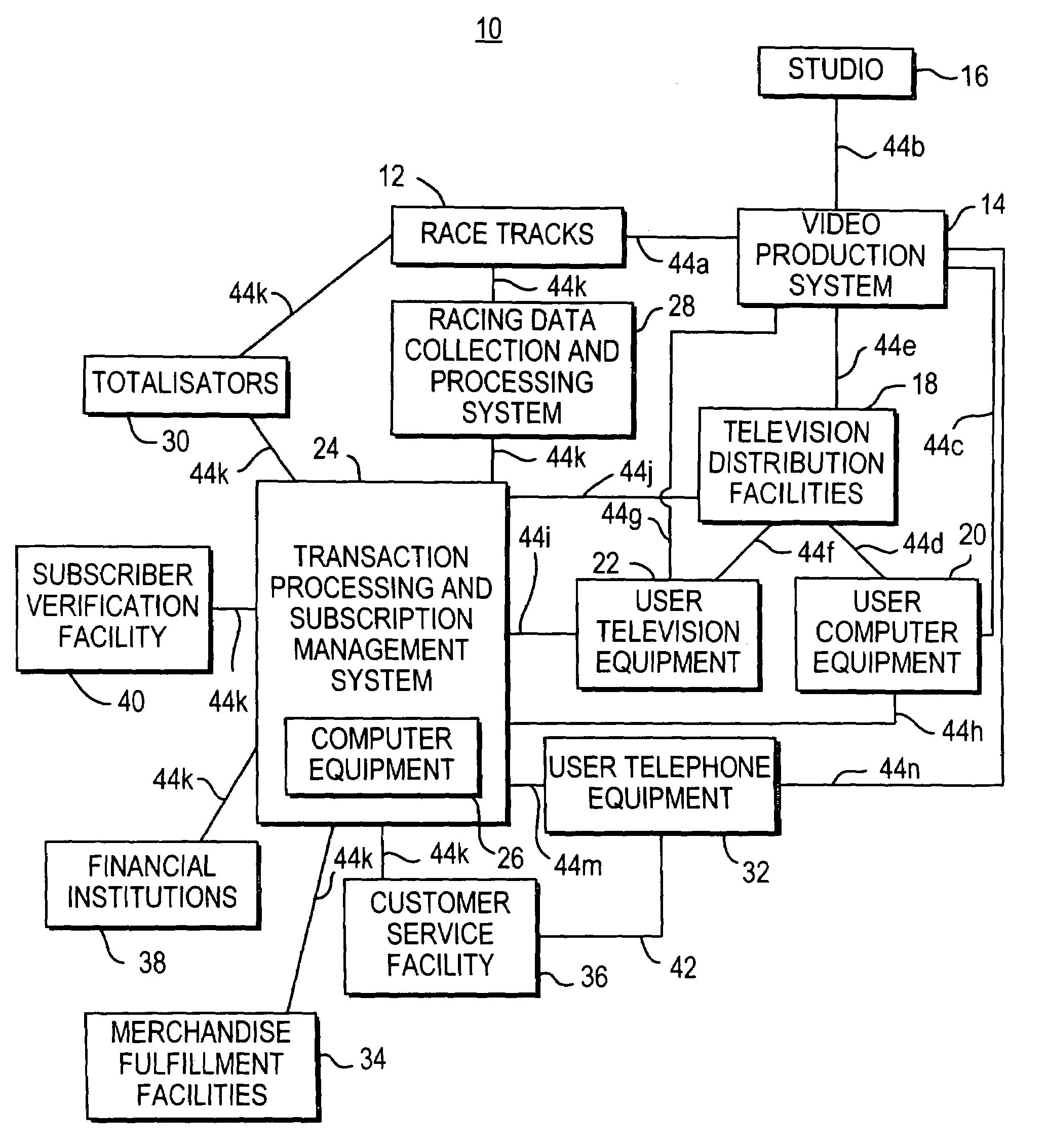

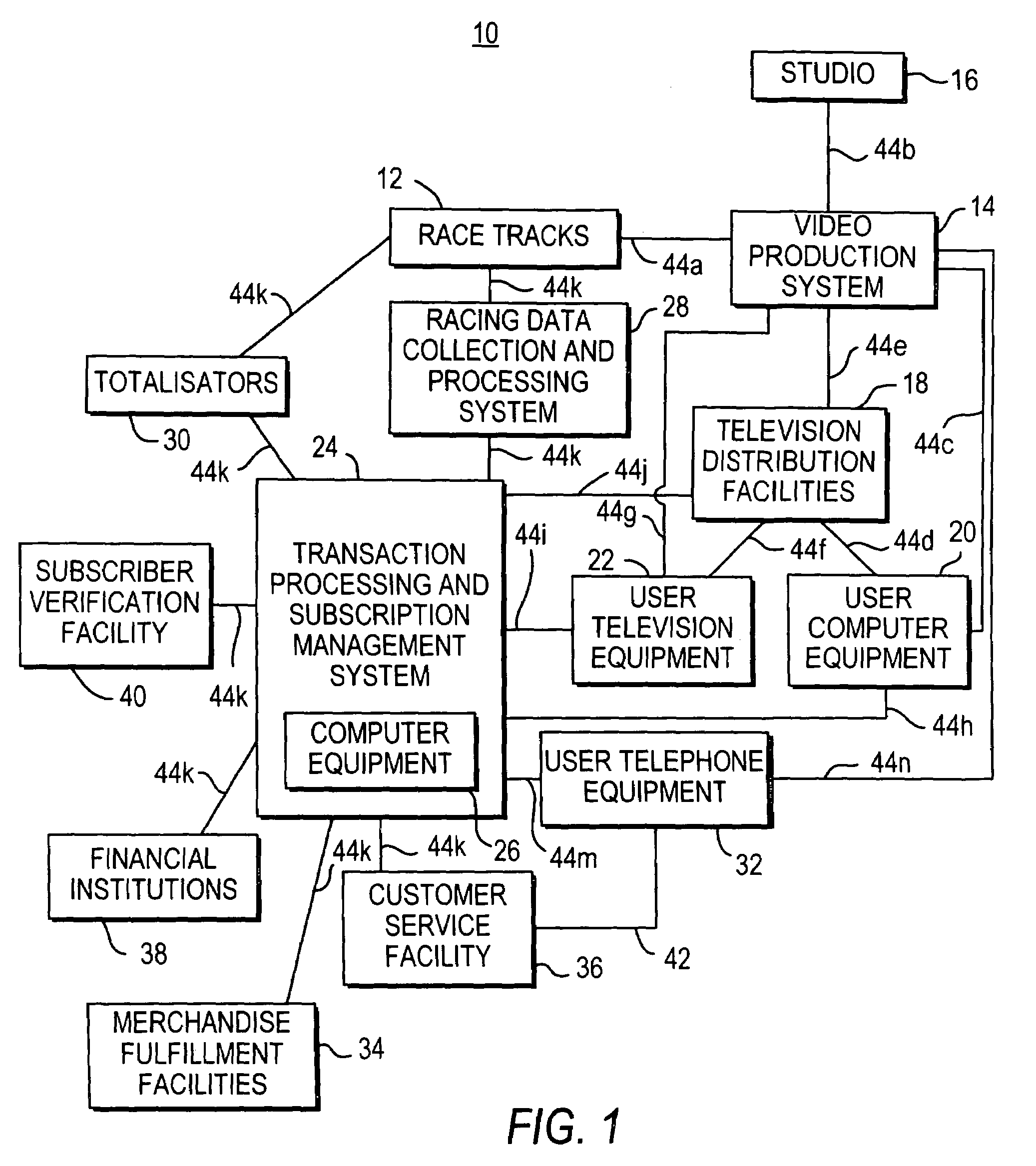

Cellular telephone interactive wagering system

InactiveUS7379886B1Easy to set upReservationsRecombinant DNA-technologyTelevision equipmentTransaction processing system

Systems and processes for interactive wagering are provided. A cellular telephone or handheld computing device may be used to access an interactive wagering service. Television equipment and computer equipment may be used to access the service. A user may view information on wagers such as current odds and other racing data for horses or other runners on the cellular telephone or other device. The user may create a corresponding off-track wager with the cellular telephone or other device that may be sent to a transaction processing and subscription management system. The transaction processing and subscription management system may handle the wager transaction and adjust the user's account balance.

Owner:ODS PROPERTIES

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com