Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

1270 results about "Magnetic stripe card" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A magnetic stripe card is a type of card capable of storing data by modifying the magnetism of tiny iron-based magnetic particles on a band of magnetic material on the card. The magnetic stripe, sometimes called swipe card or magstripe, is read by swiping past a magnetic reading head. Magnetic stripe cards are commonly used in credit cards, identity cards, and transportation tickets. They may also contain an RFID tag, a transponder device and/or a microchip mostly used for business premises access control or electronic payment.

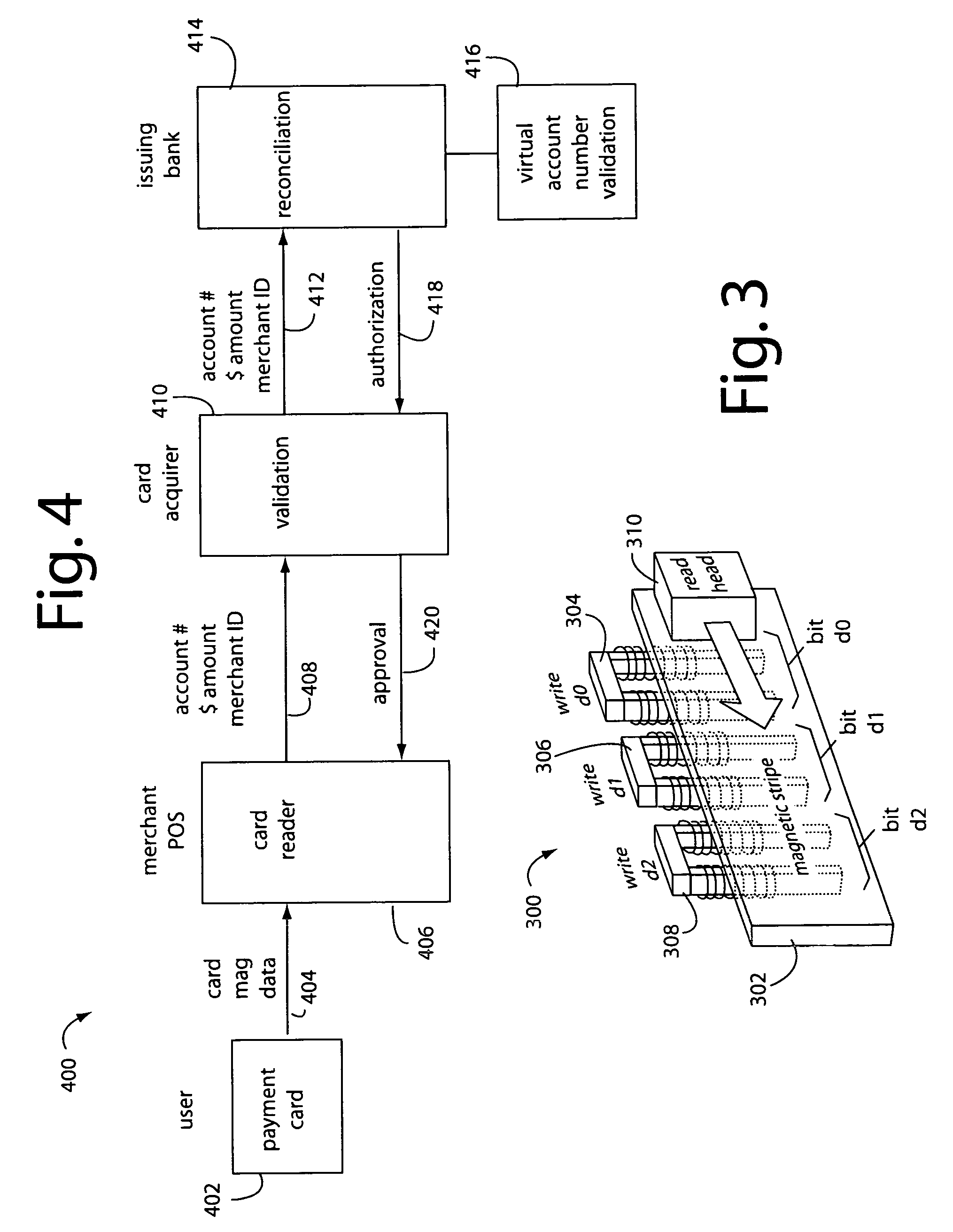

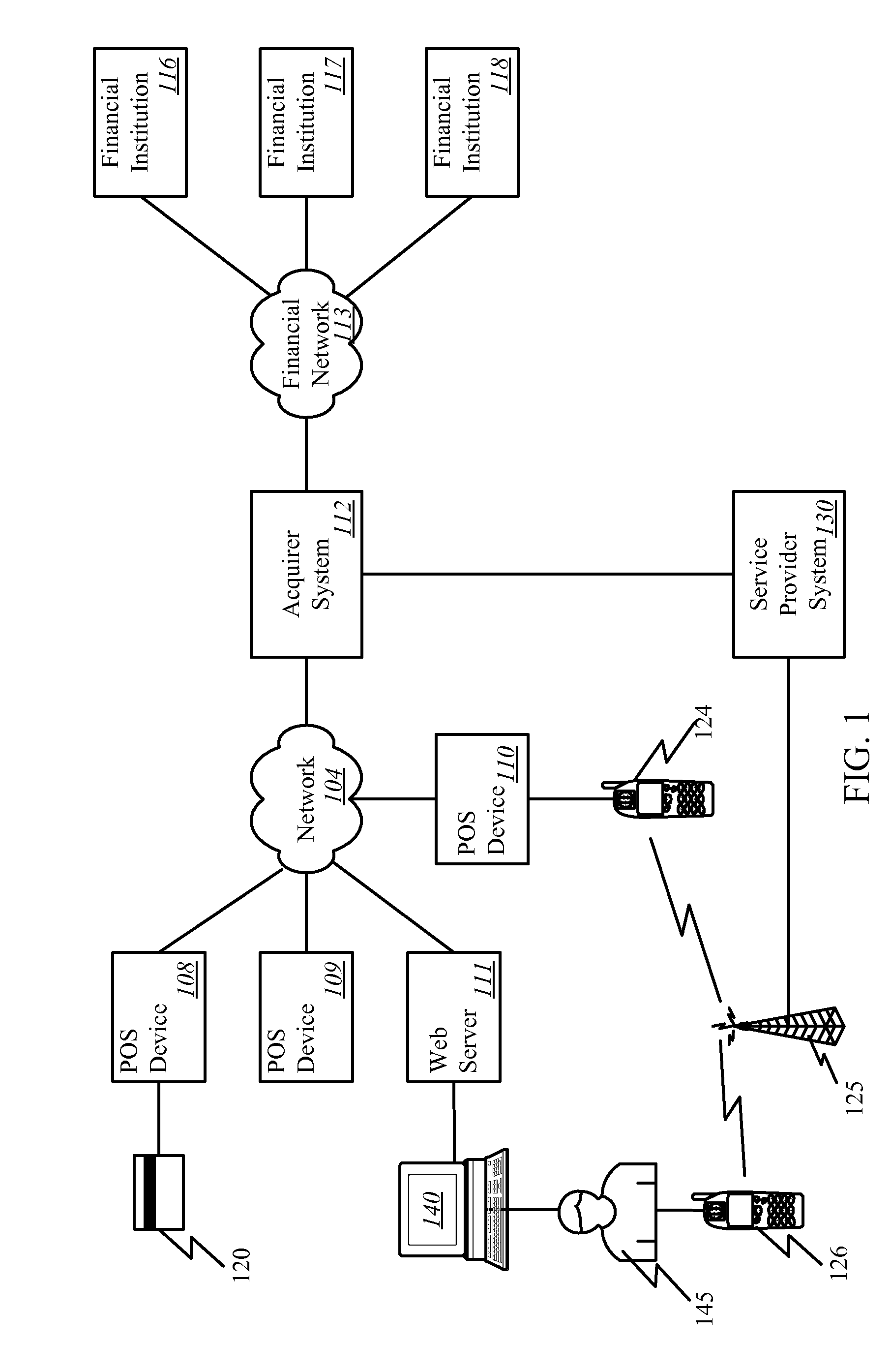

Financial transactions with dynamic card verification values

ActiveUS7584153B2Sufficient dataComputer security arrangementsPayment architectureUser needsDisplay device

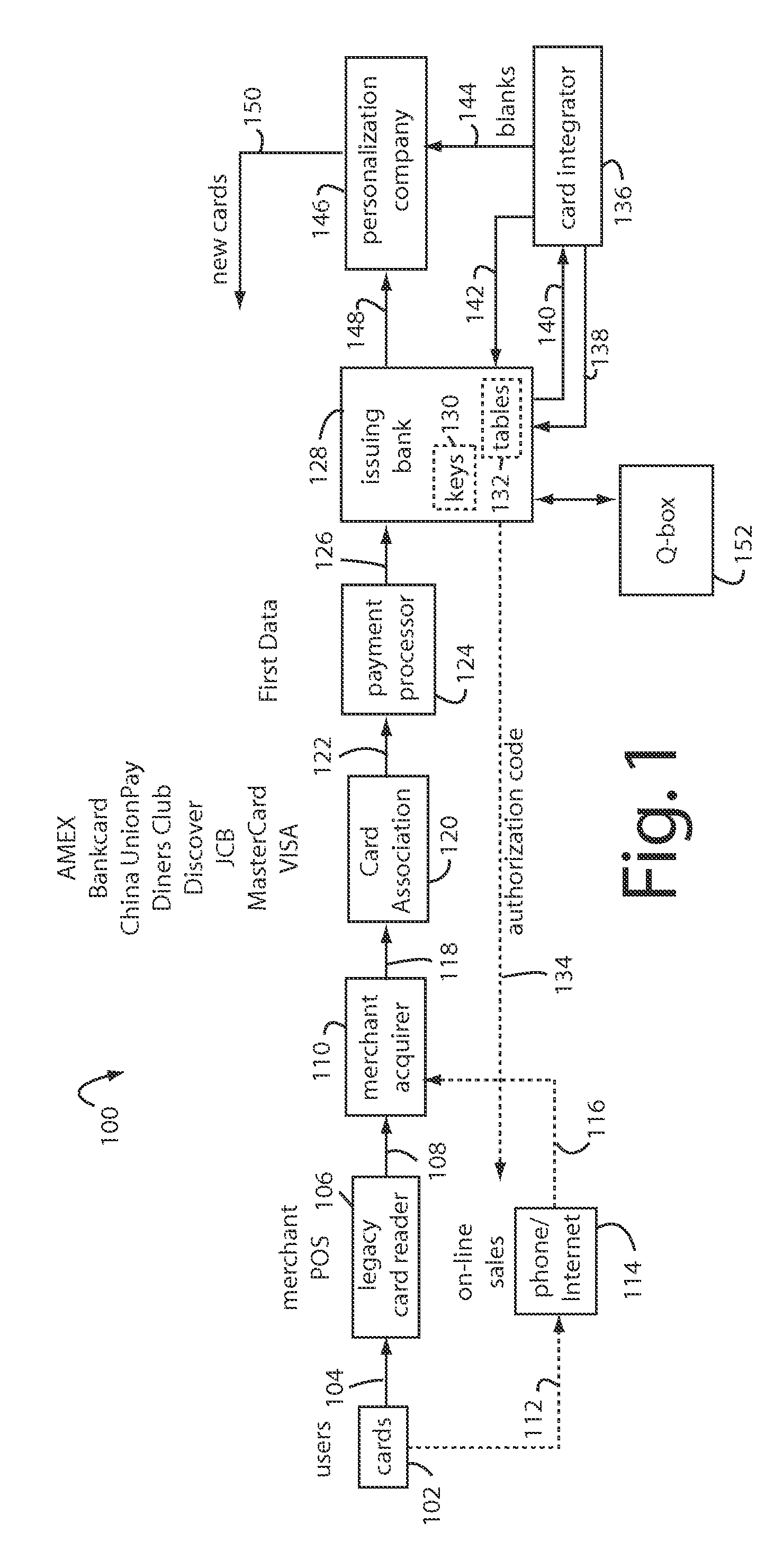

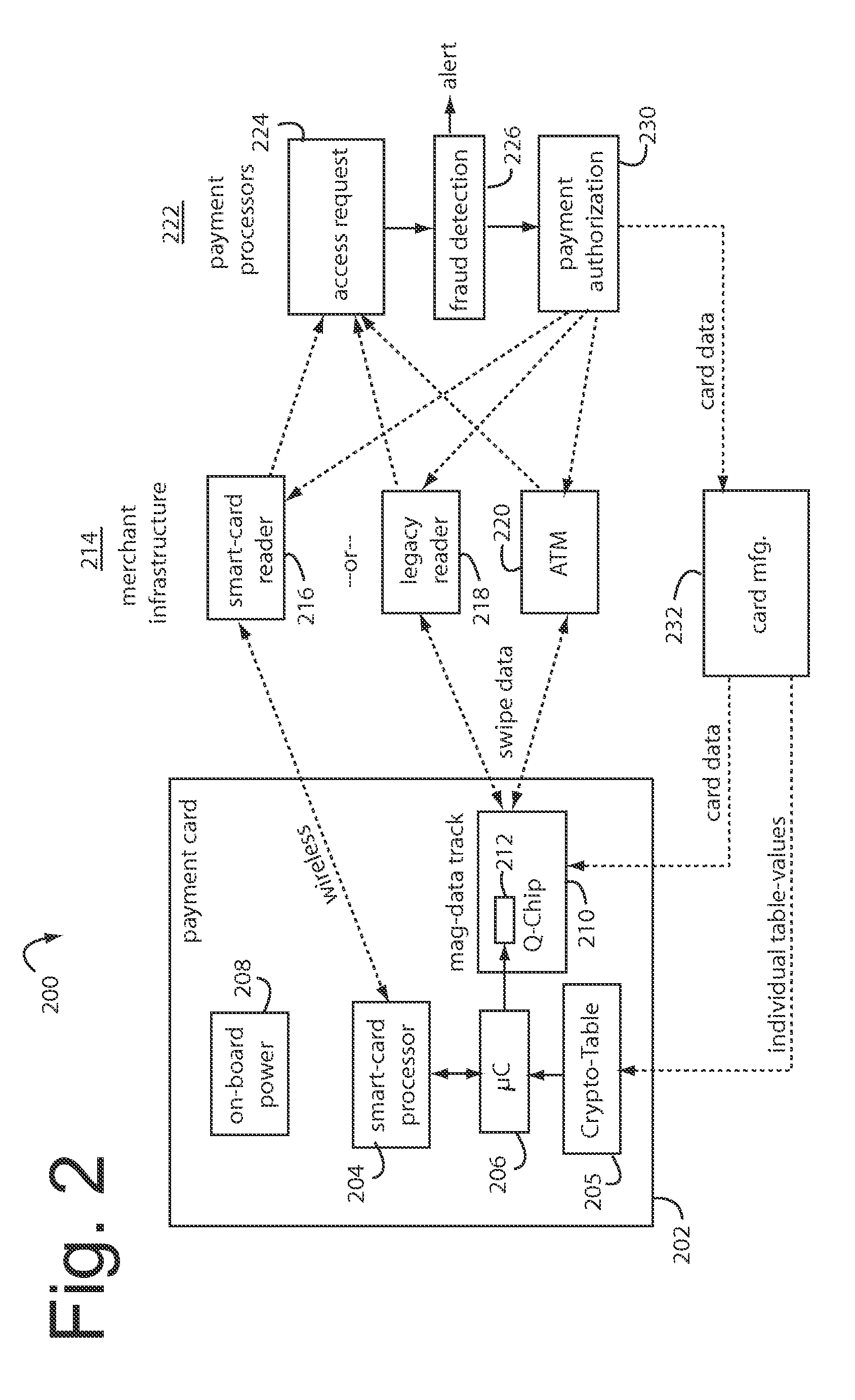

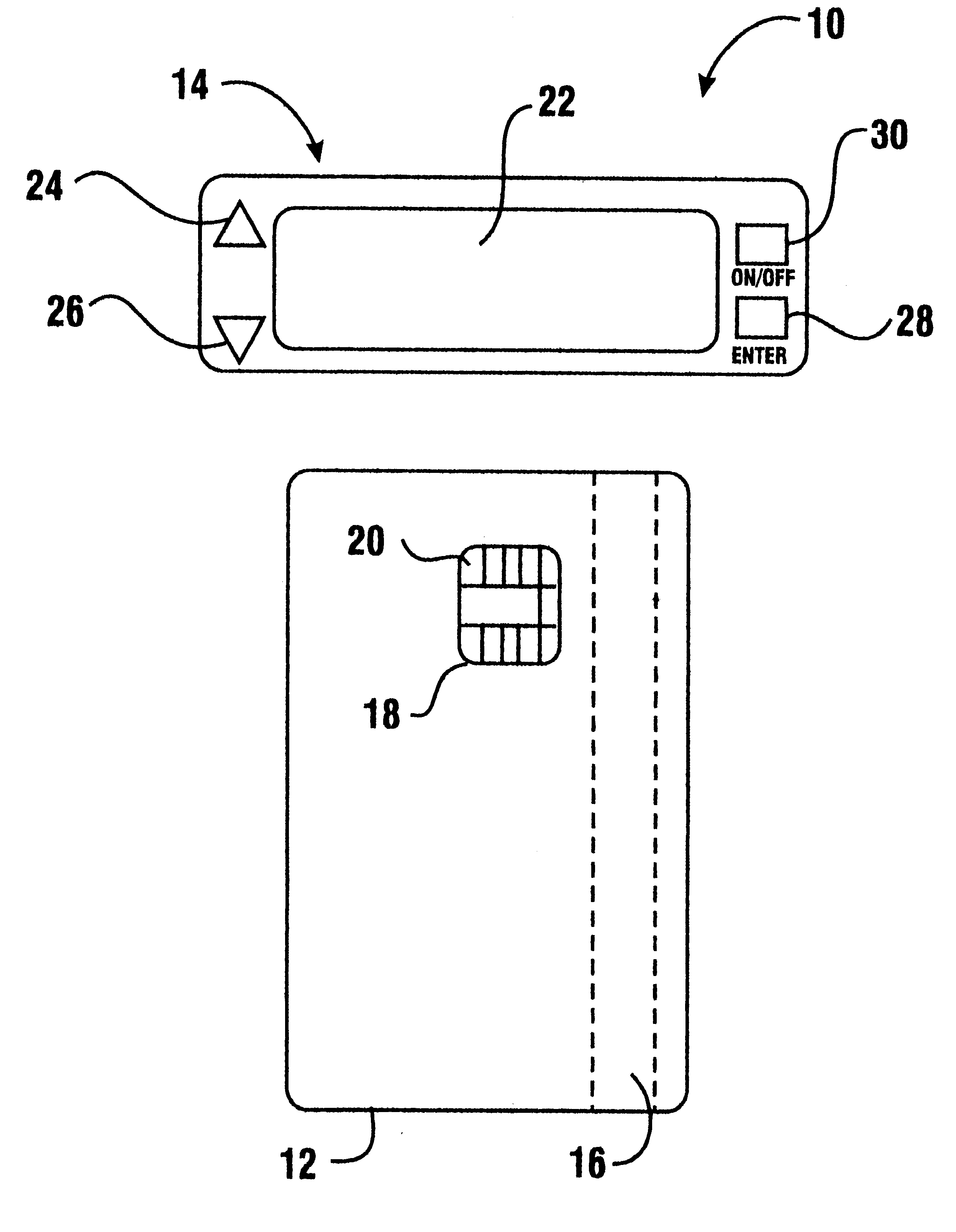

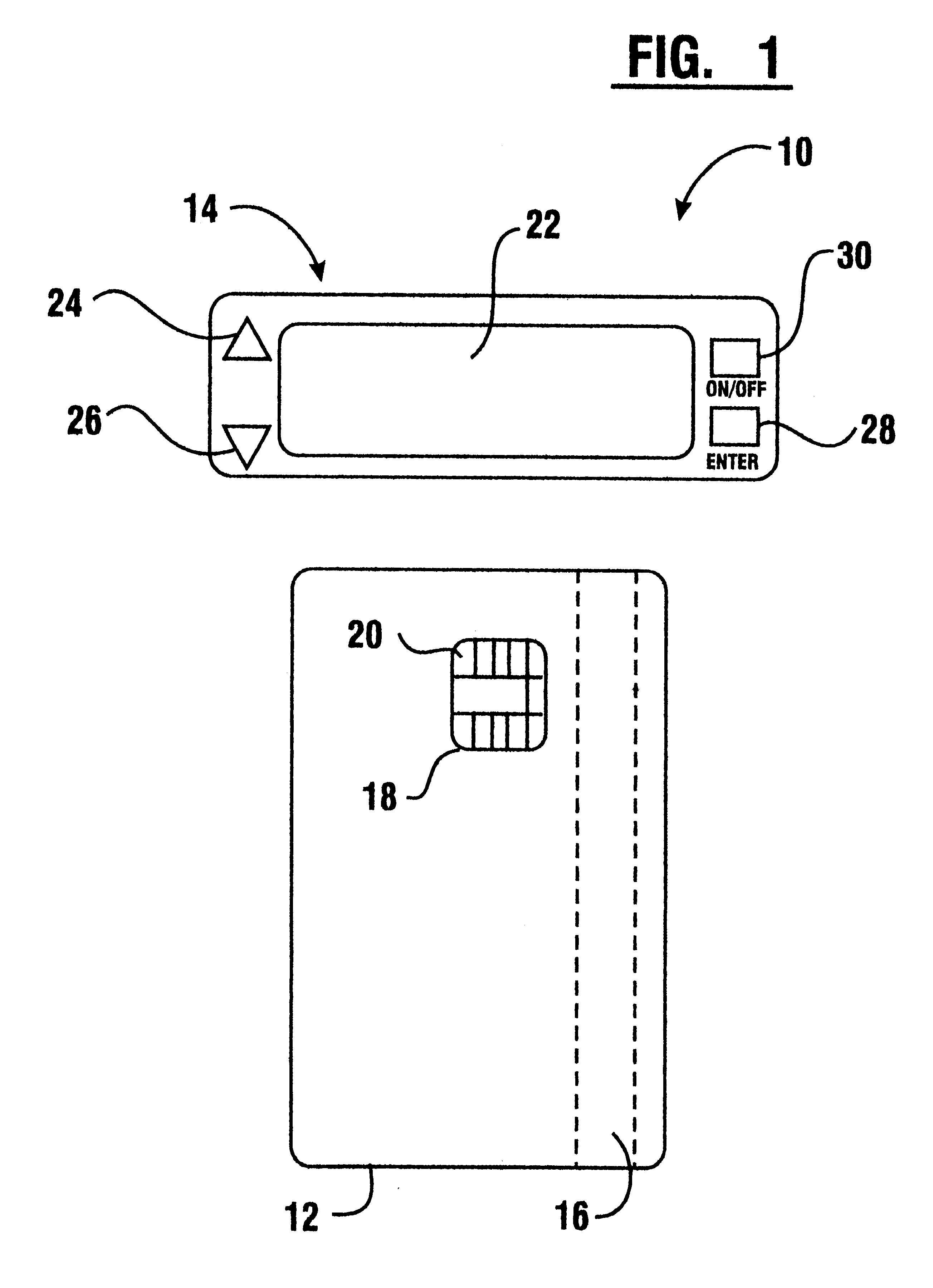

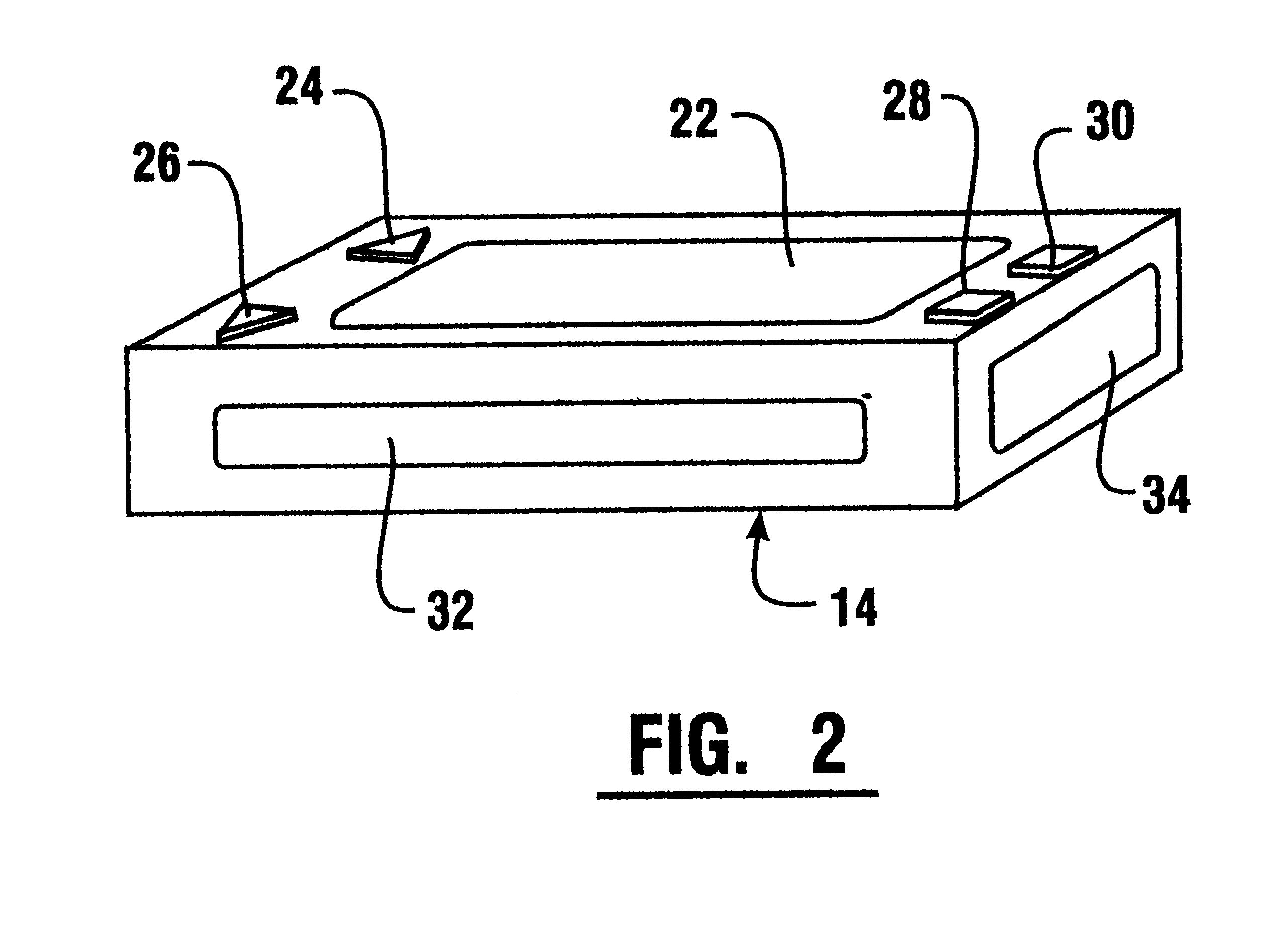

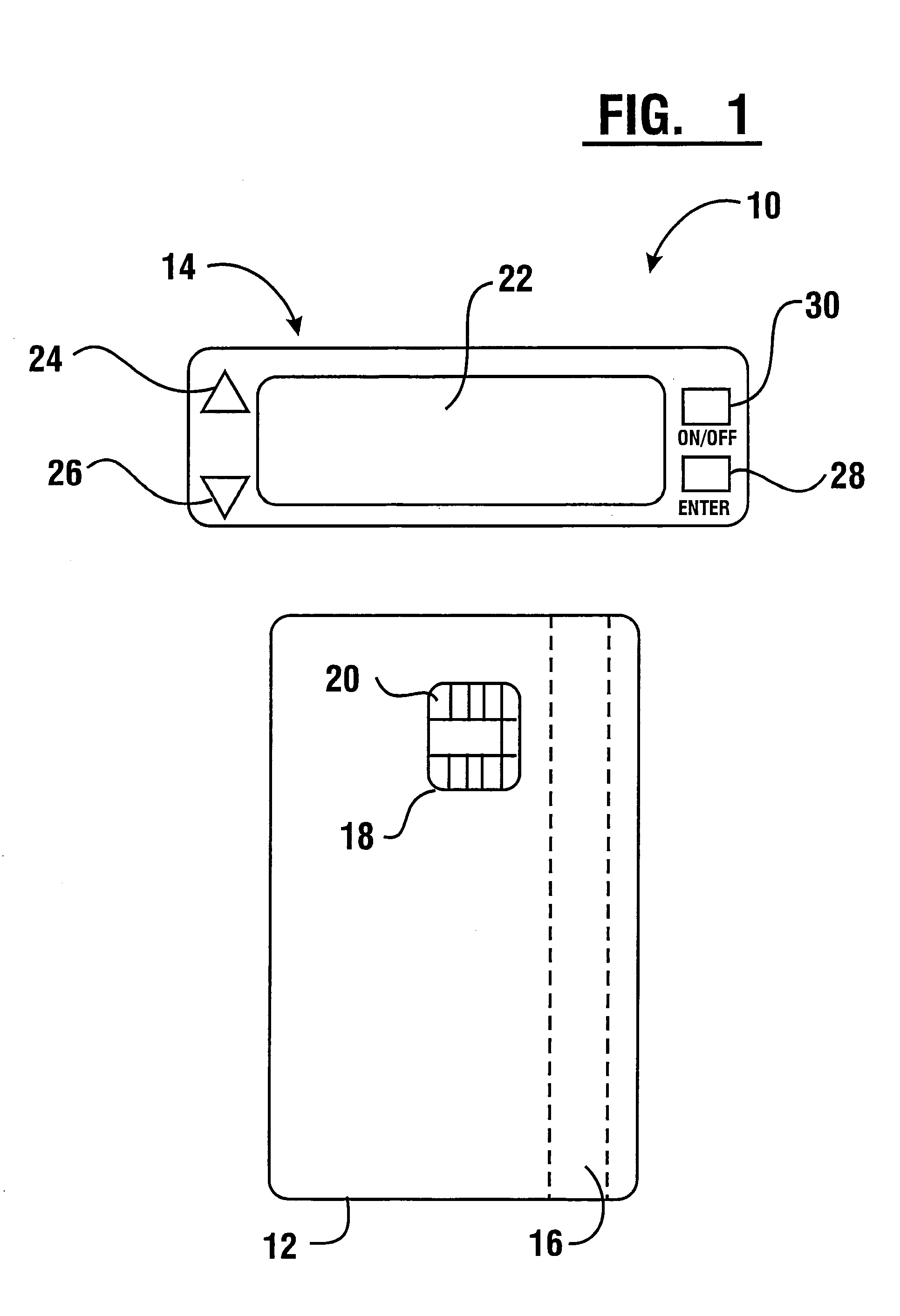

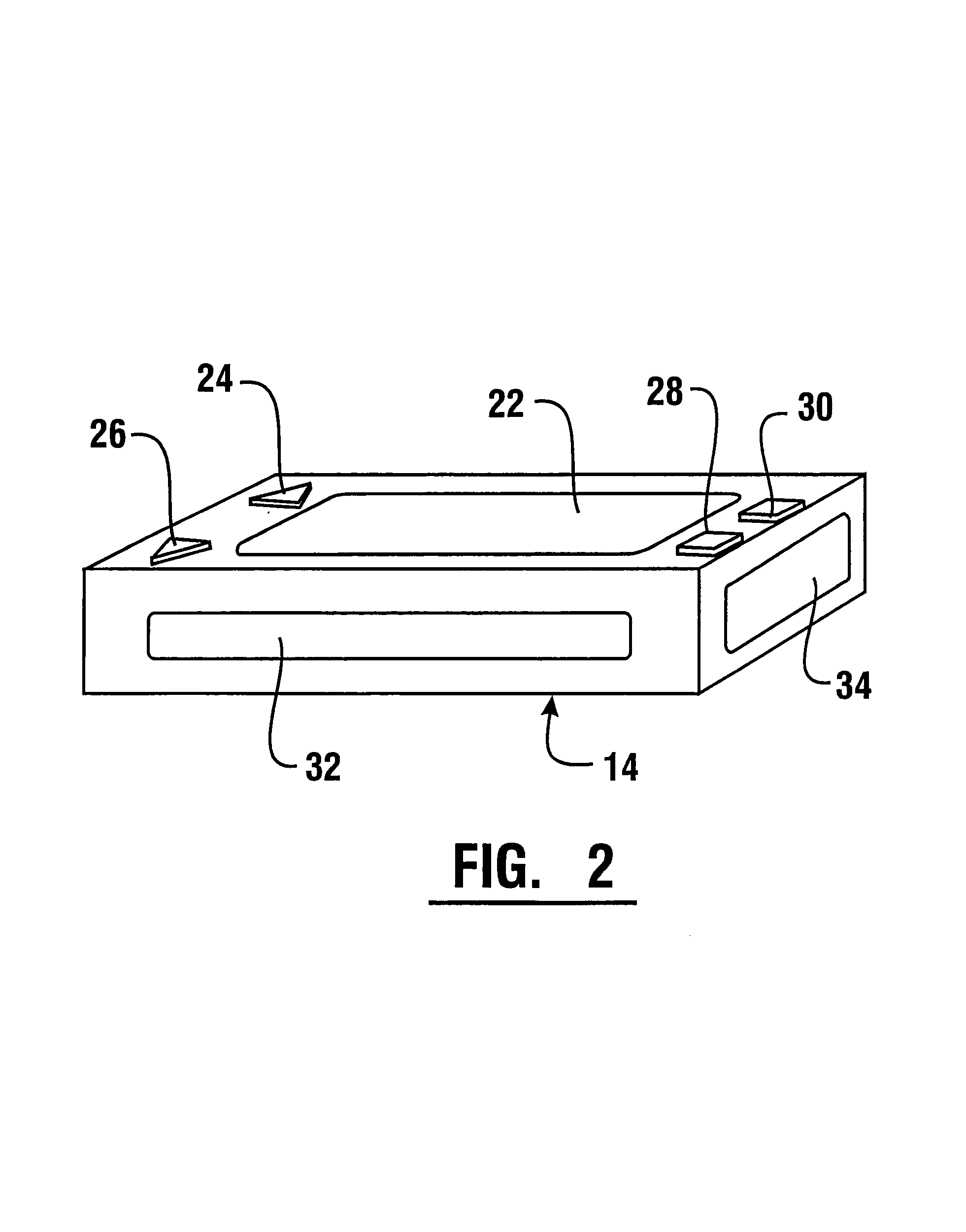

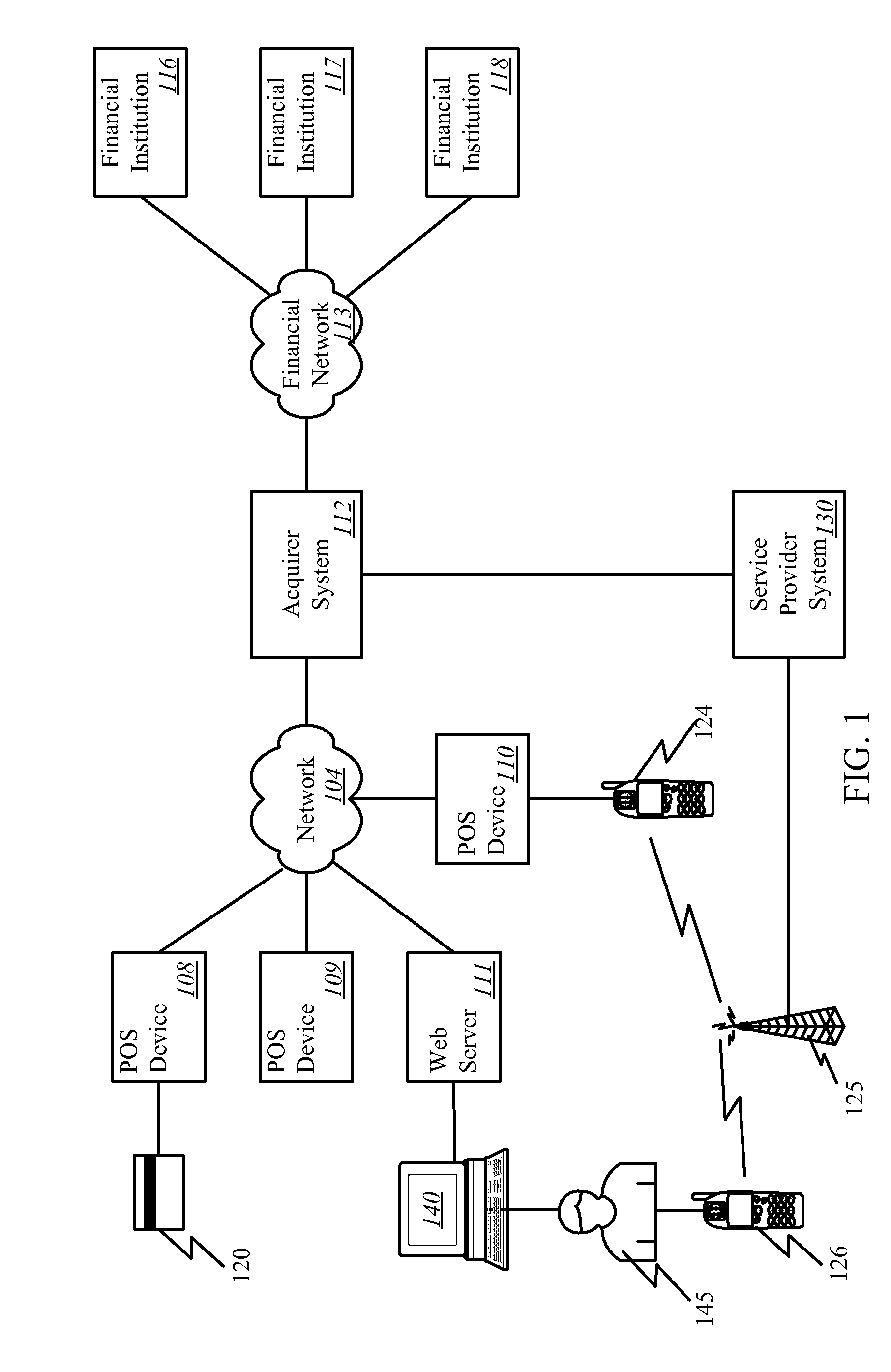

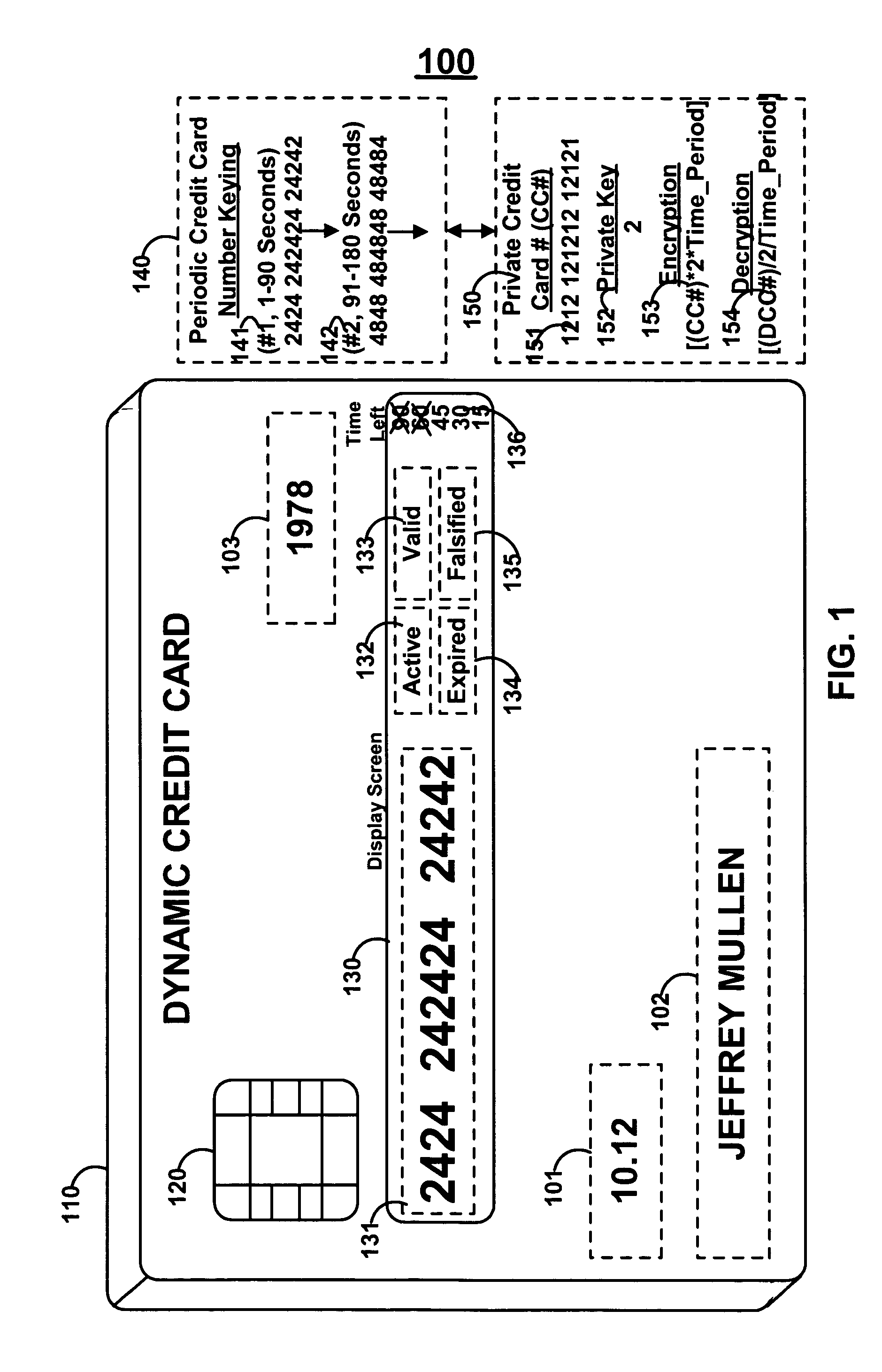

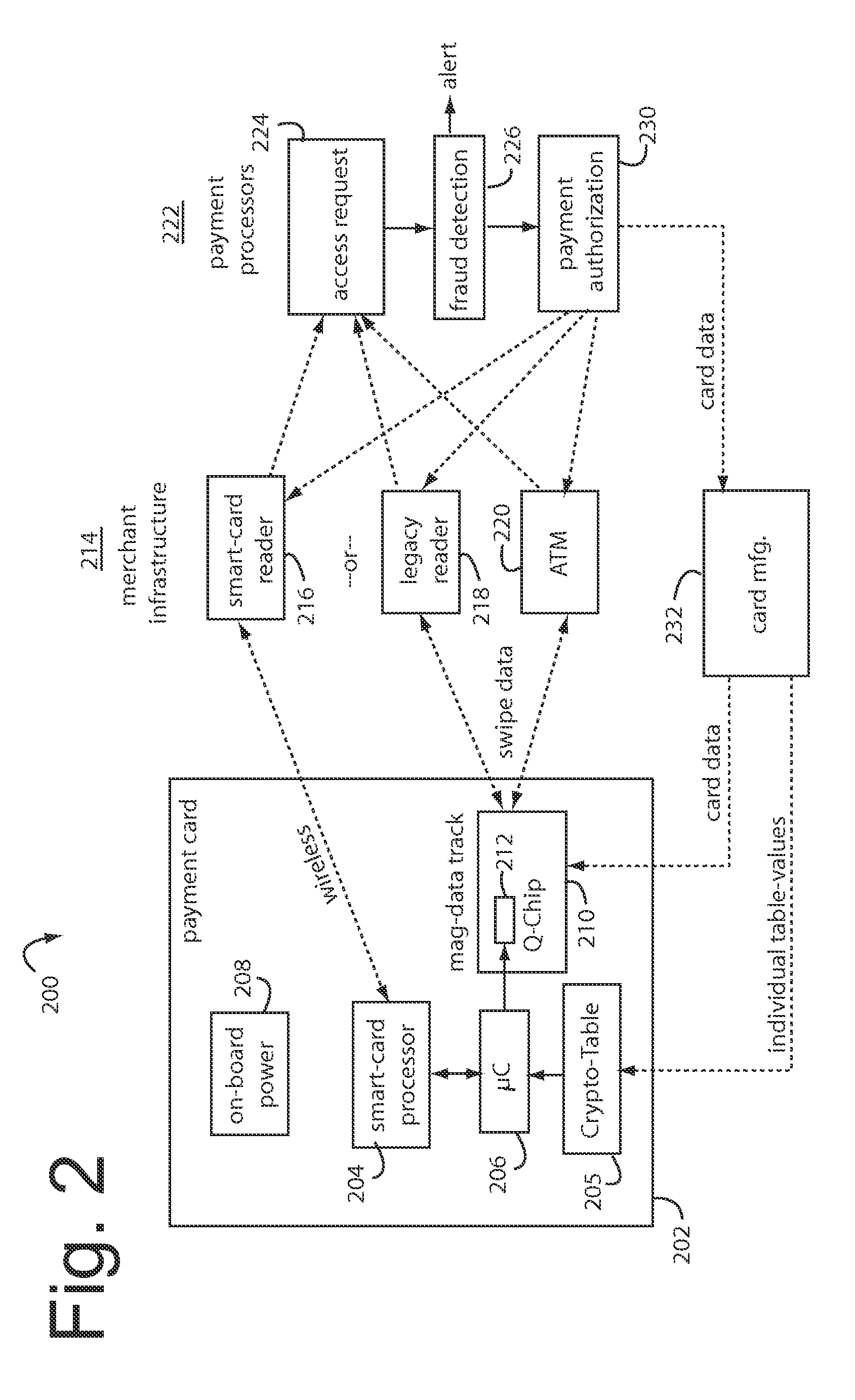

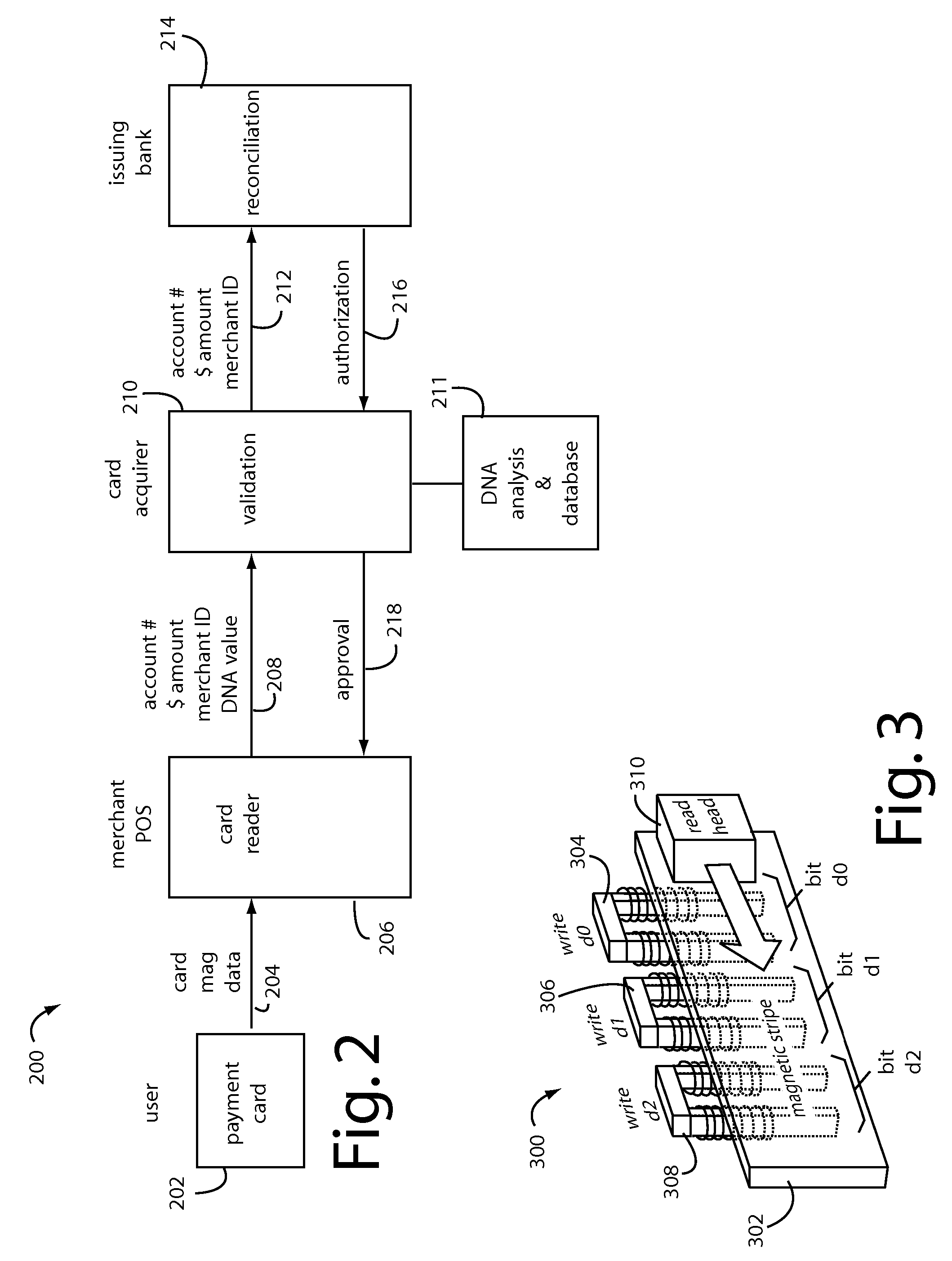

A payment card comprises an internal dynamic card verification value (CVV) generator and a user display for card-not-present transactions. Card-present transactions with merchant card readers are enabled by a dynamic magnetic array internally associated with the card's magnetic stripe. The user display and a timer are triggered by the user when the user needs to see the card verification value and / or begin a new transaction. A new card verification value is provided for each new transaction according to a cryptographic process, but the timer limits how soon a next new card verification value can be generated.

Owner:FITBIT INC

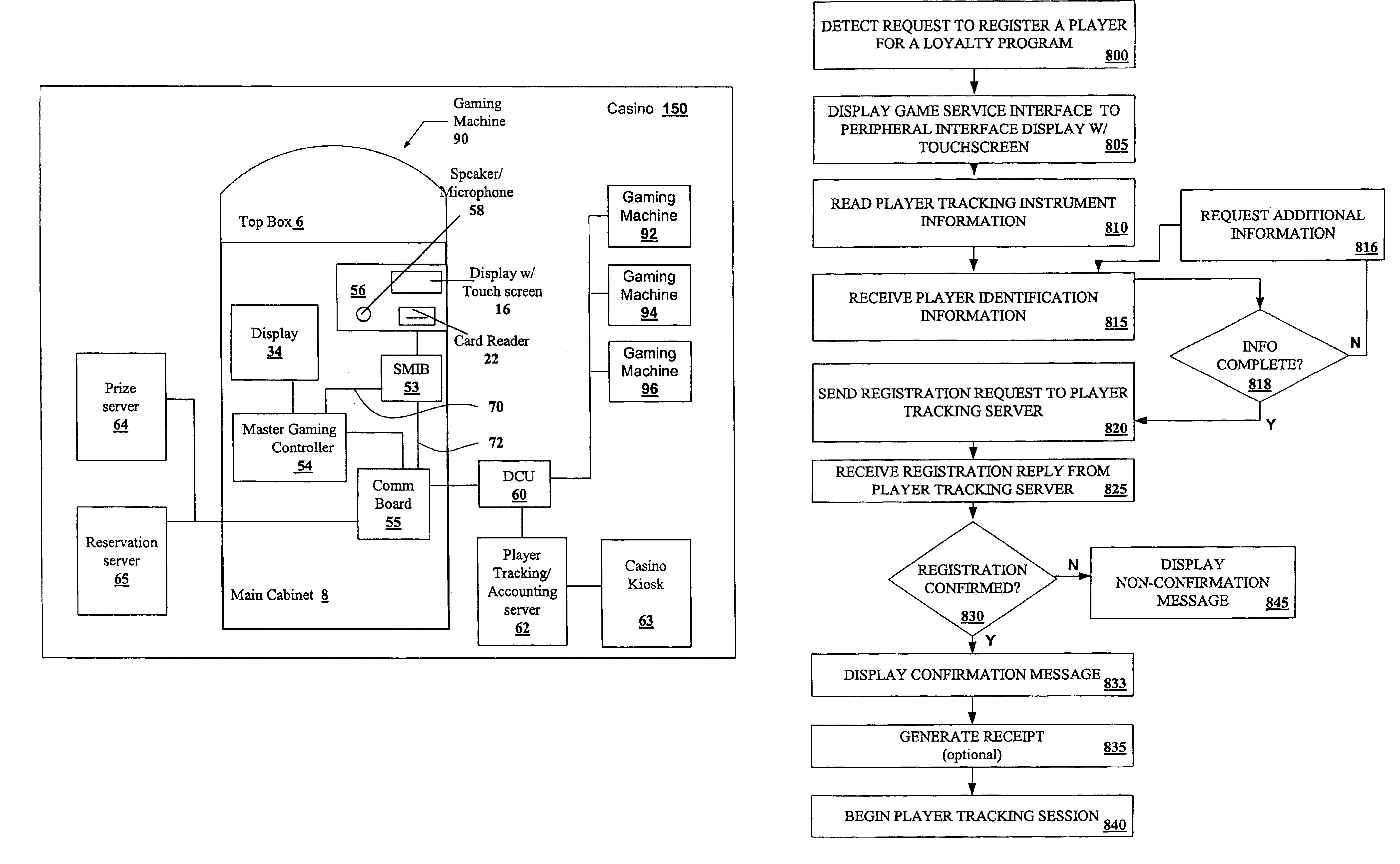

Point of play registration on a gaming machine

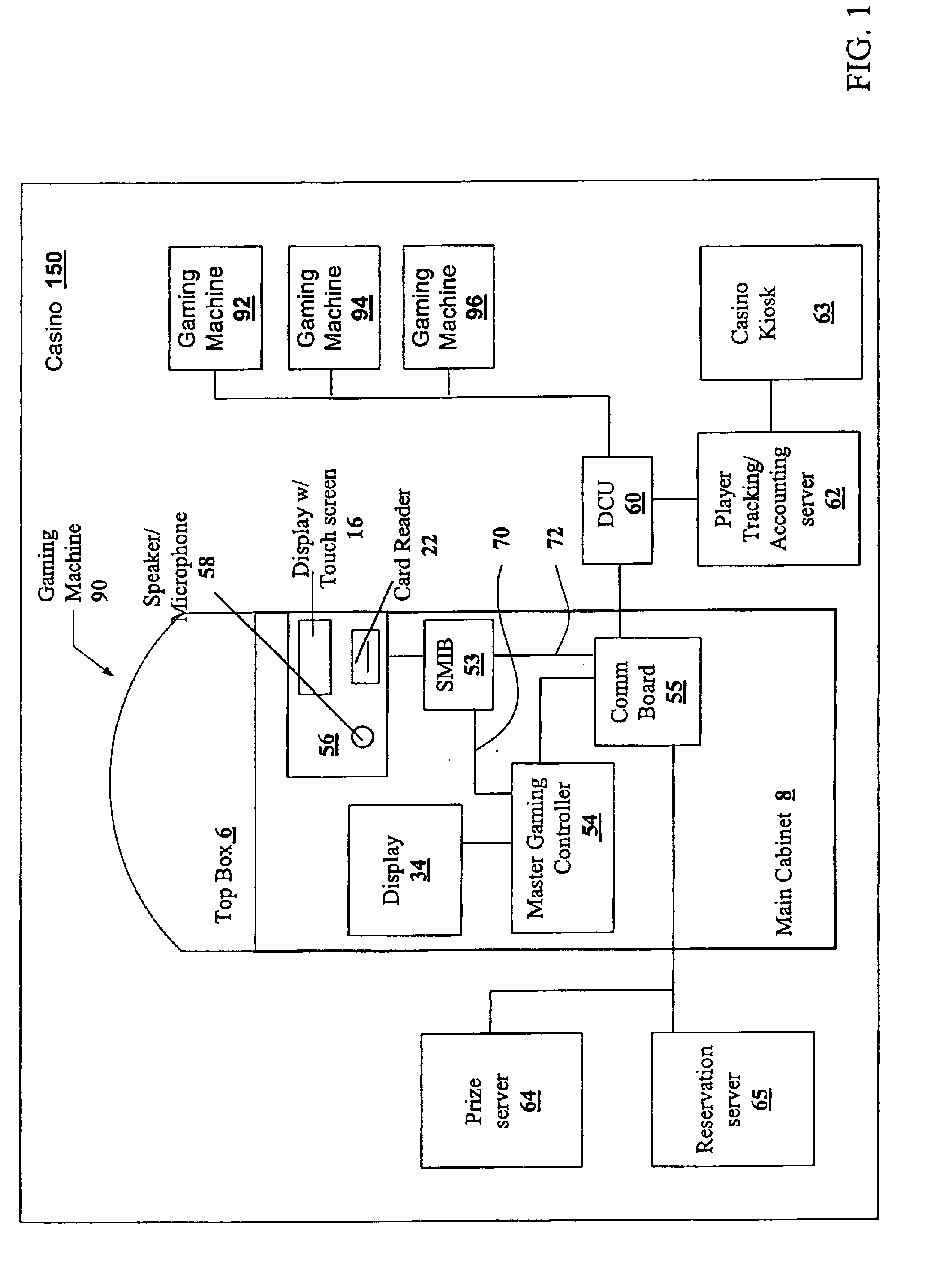

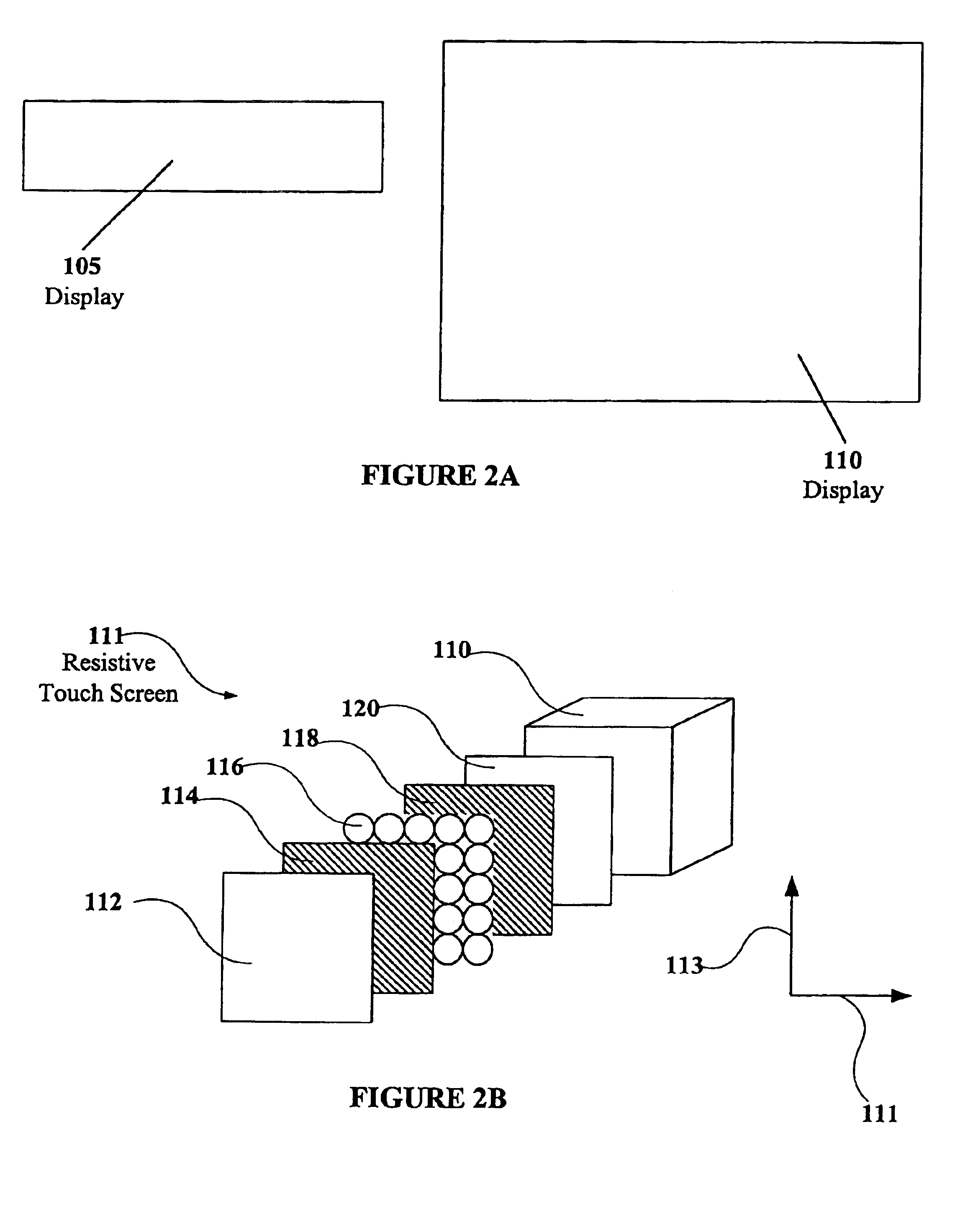

A disclosed gaming machine is used to provide a method of registering a player to a loyalty program such as a player tracking program at the gaming machine. At the gaming machine, the player or a casino service representative may enter identification information such as a name, an address and biometric information using an input mechanism located on the gaming machine or on a hand-held wireless device. The loyalty program information may be combined with information such as serial number or a bar-code read from a loyalty program instrument in a loyalty program registration request message sent to a loyalty program server such as a player tracking server. The loyalty program instrument may include a magnetic striped card, a smart card, a printed ticket, a room key, a cell-phone or a portable computing device. When the registration request is confirmed by the loyalty program server, the player may begin a loyalty program session on a gaming machine and earn loyalty points.

Owner:IGT

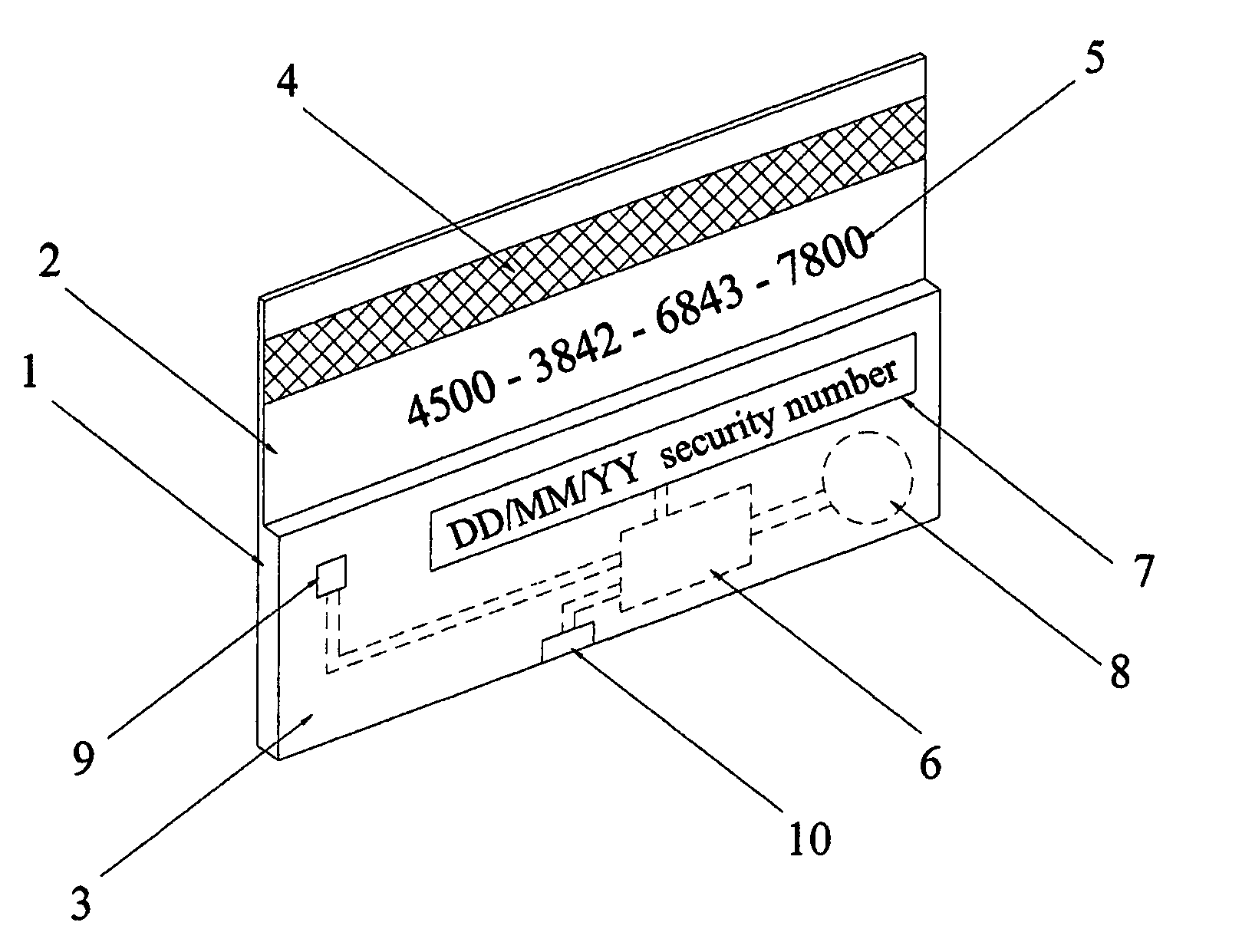

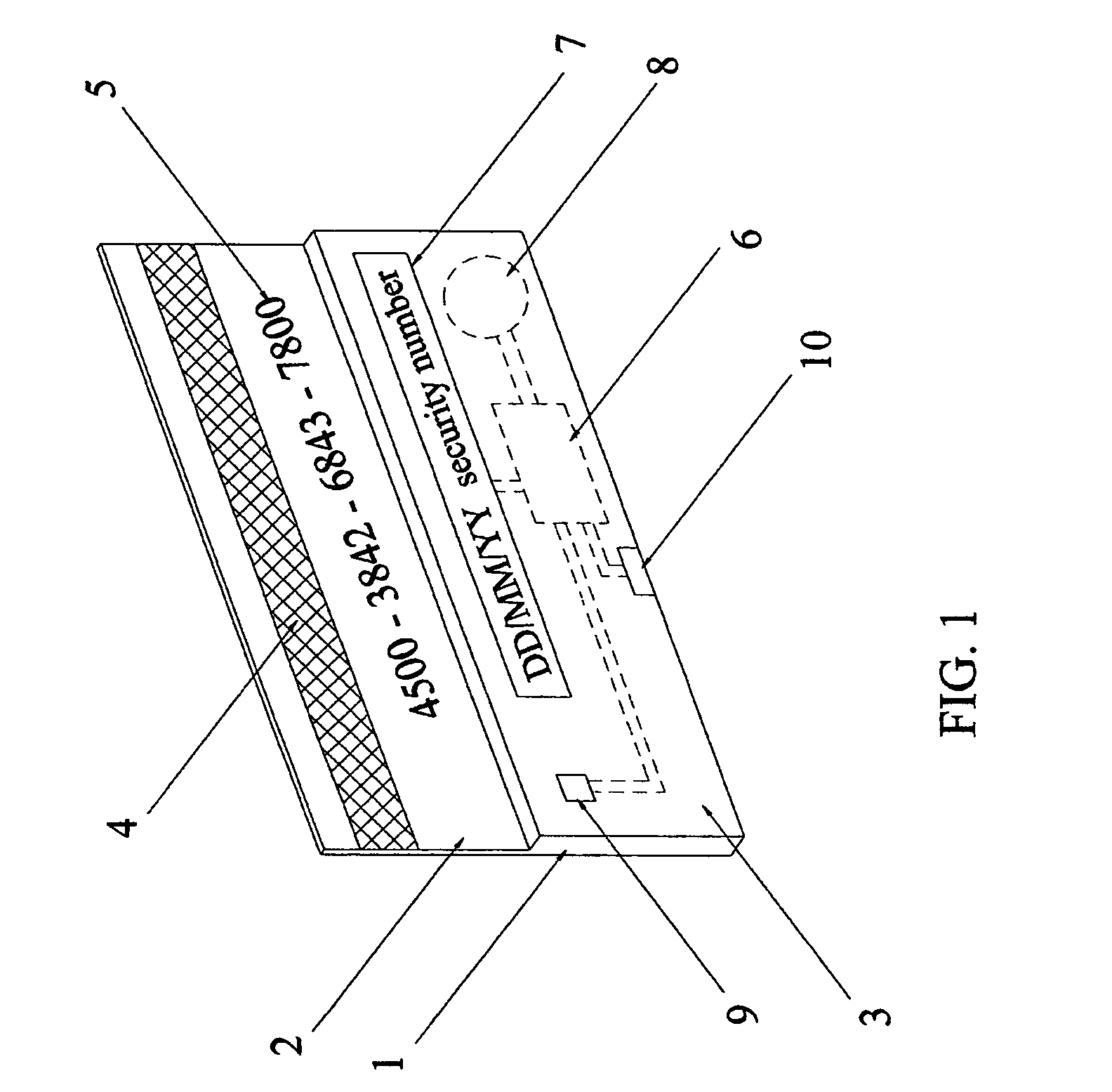

Secure credit card having daily changed security number

InactiveUS7051929B2Enhance memorySimple technologyPayment architectureRecord carriers used with machinesCredit cardThe Internet

Owner:LI GONGLING

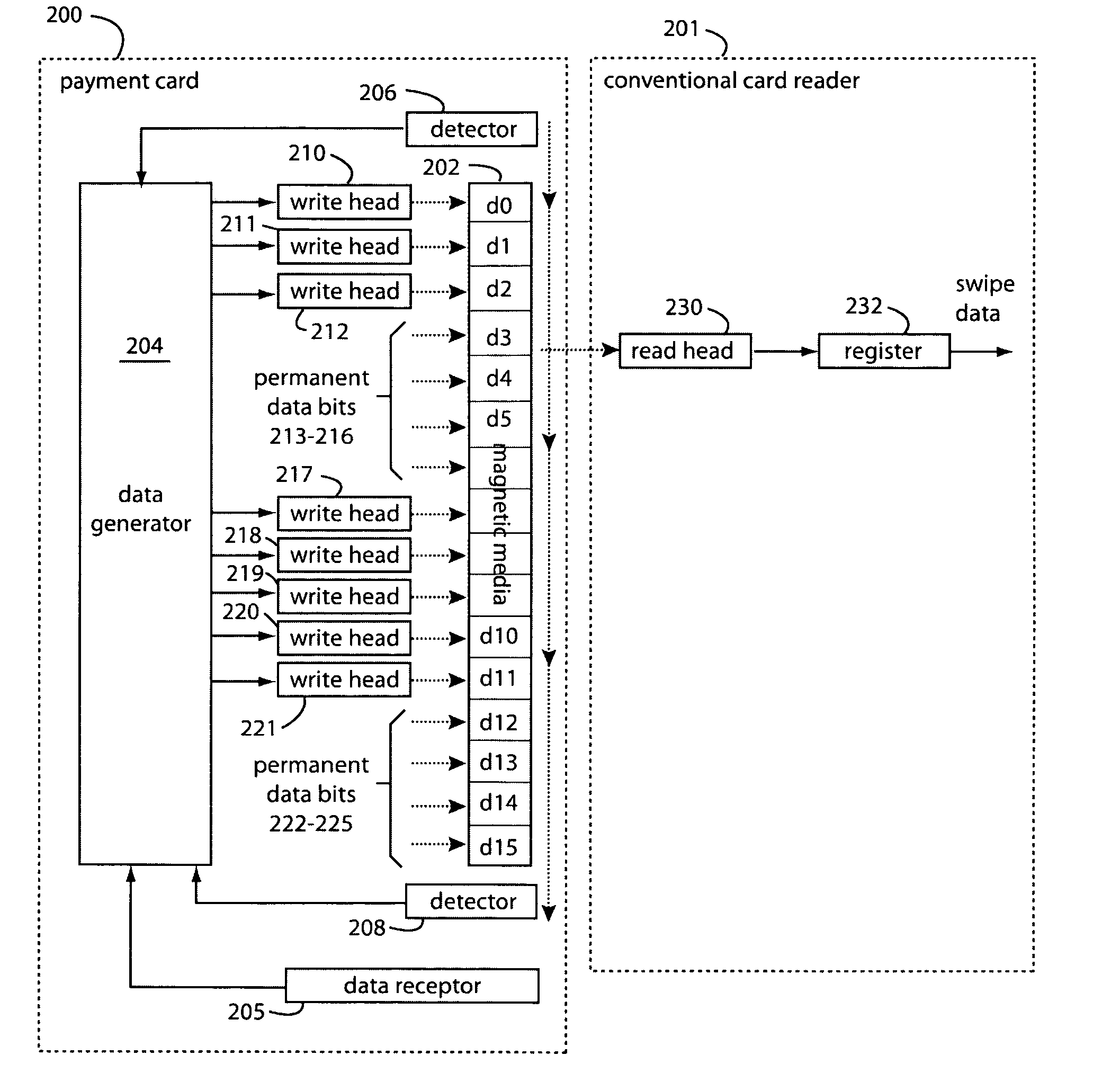

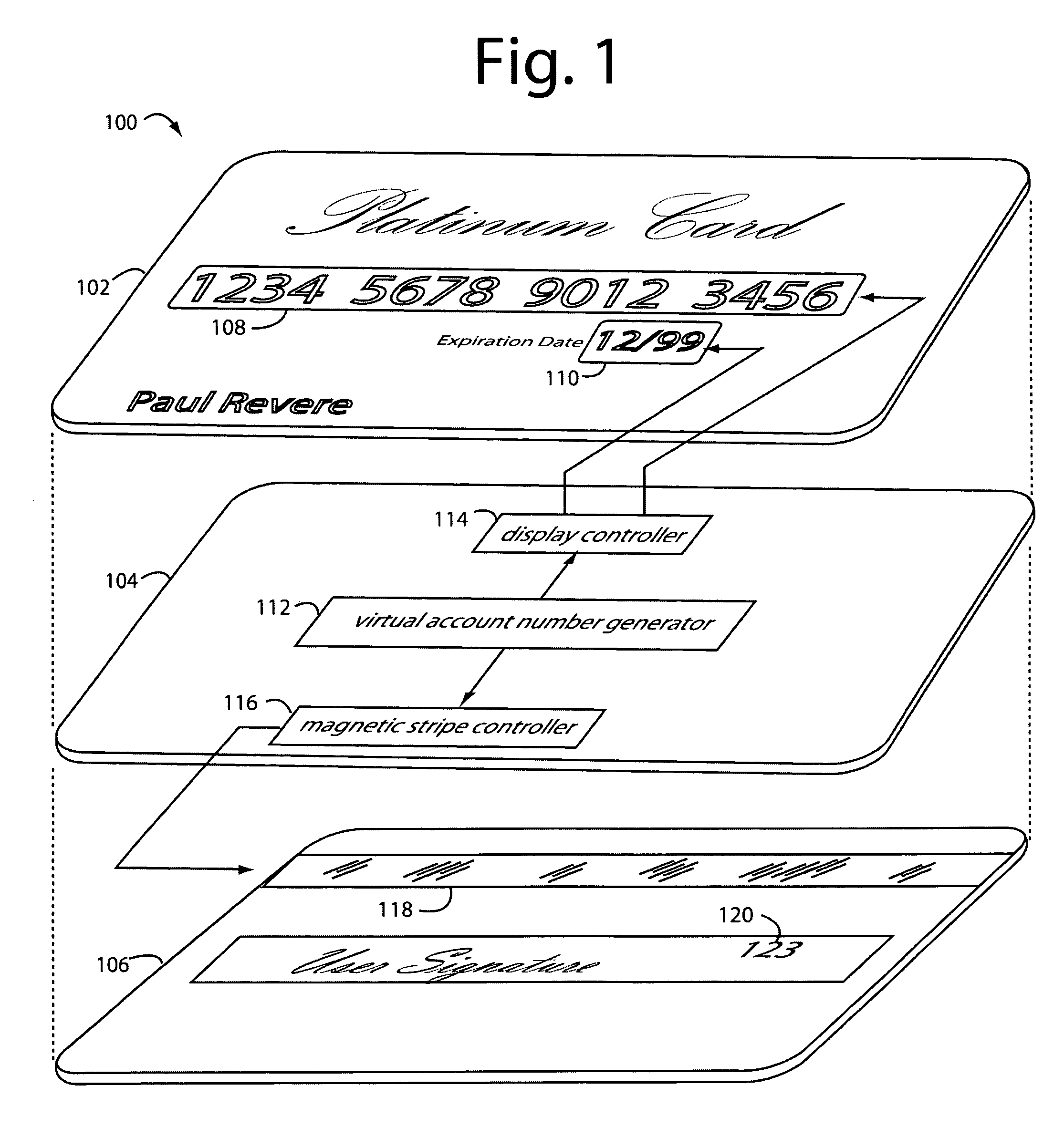

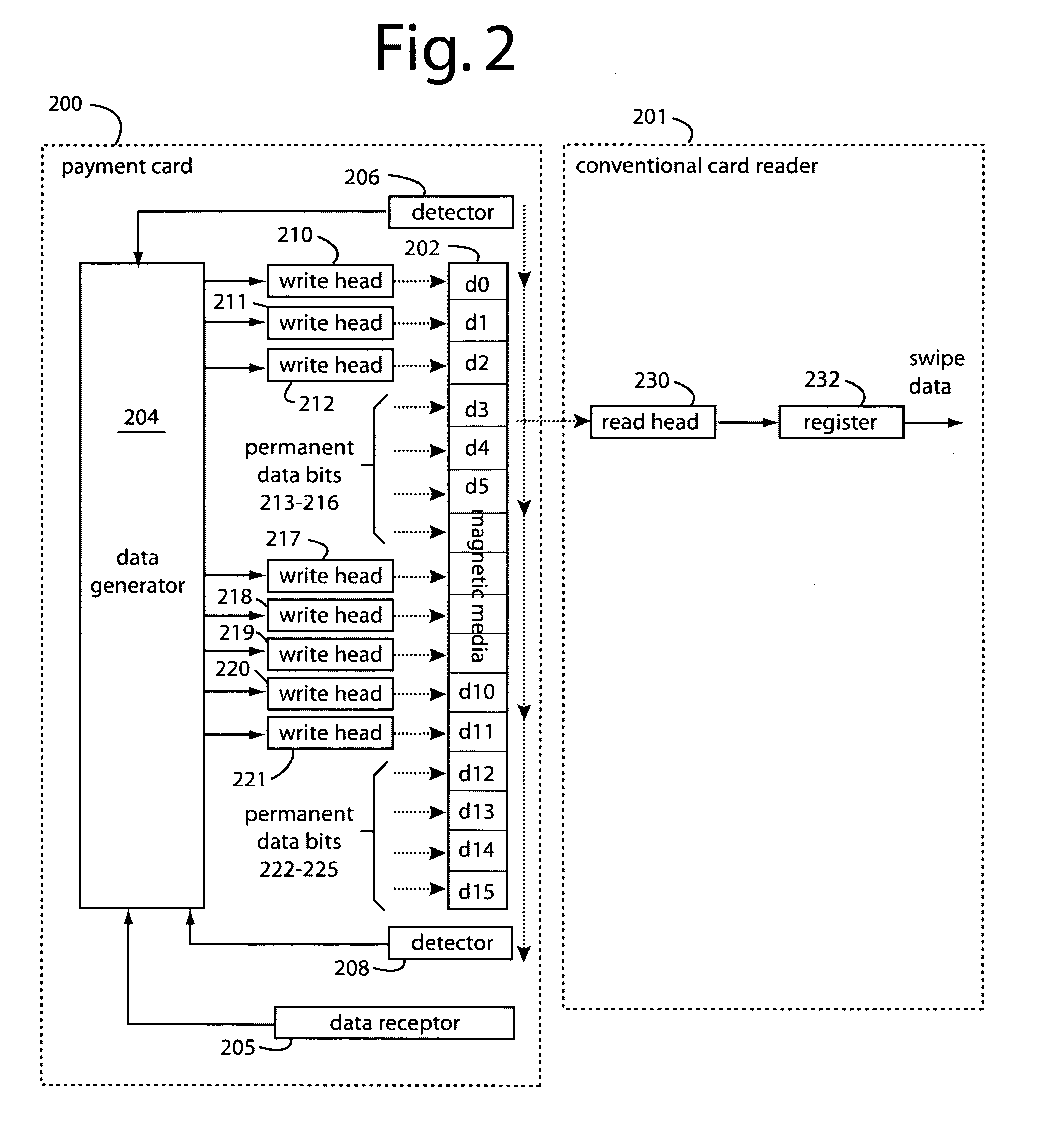

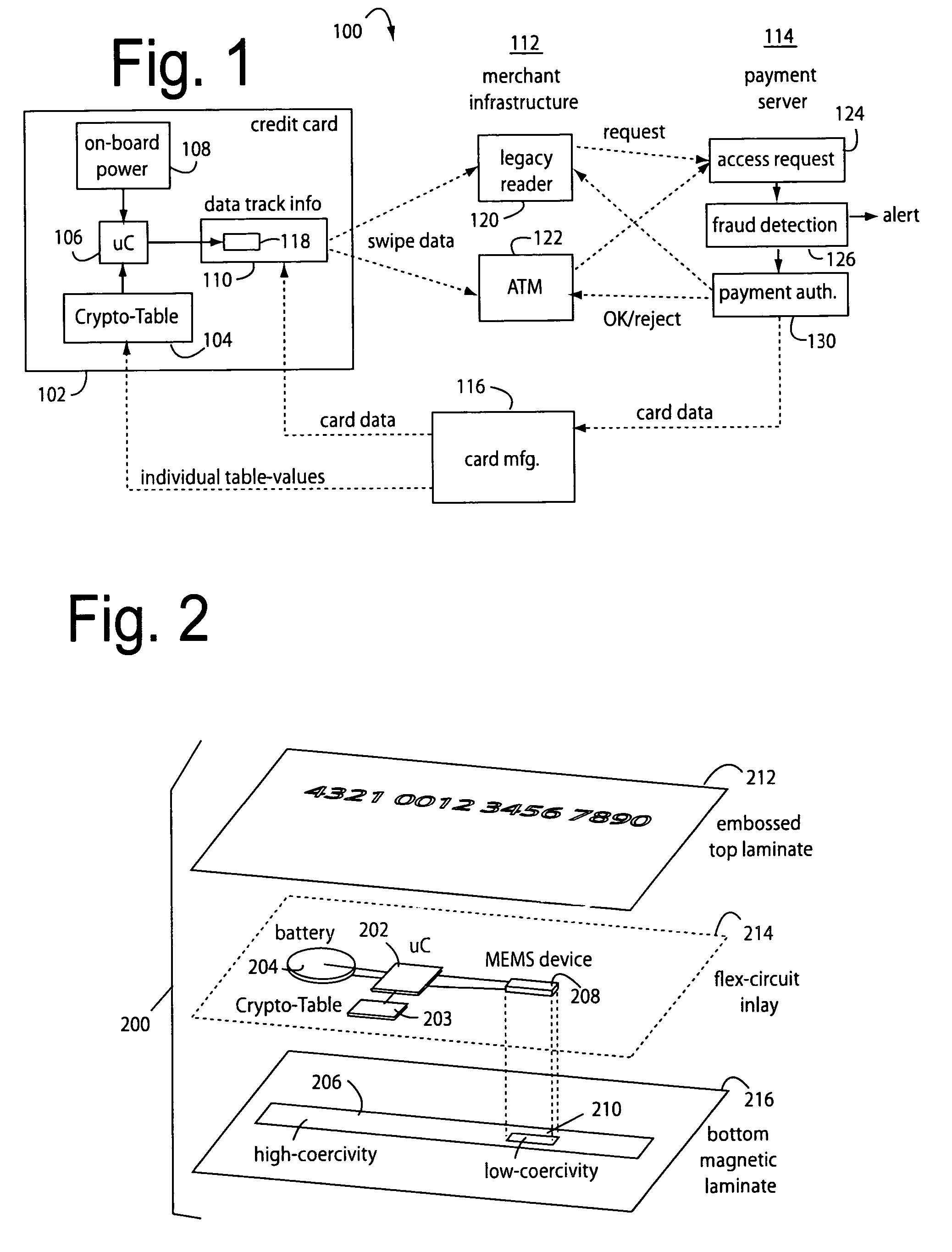

Payment card with internally generated virtual account numbers for its magnetic stripe encoder and user display

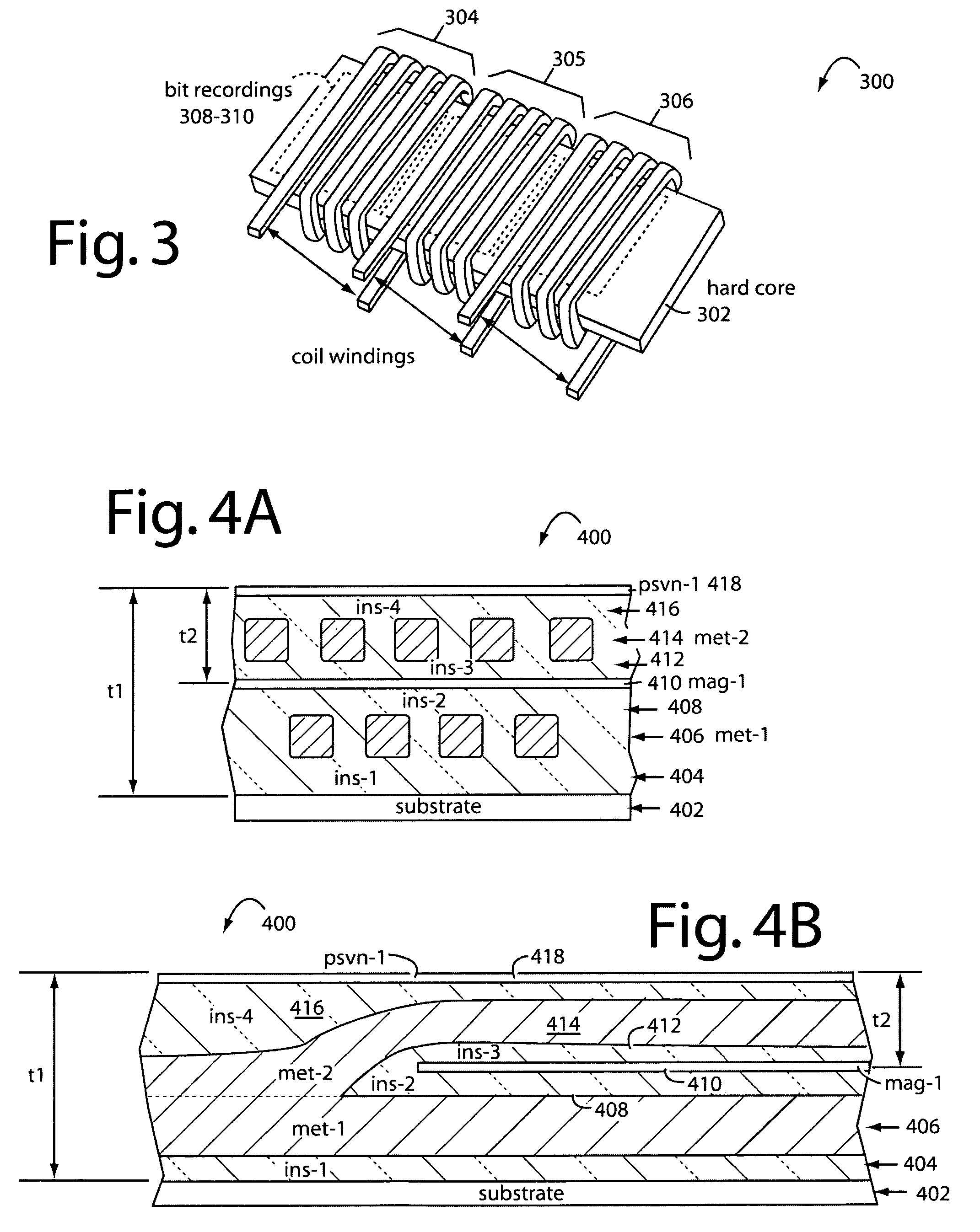

A payment card comprises an internal virtual account number generator and a user display for online transactions. Offline transactions with merchant card readers are enabled by a magnetic array positioned behind the card's magnetic stripe on the back. The internal virtual account number generator is able to program the magnetic bits encoded in the magnetic stripe to reflect the latest virtual account number. The internal virtual account number generator produces a sequence of virtual numbers that can be predicted and approved by the issuing bank. Once a number is used, it is discarded and put on an exclusion list.

Owner:FITBIT INC

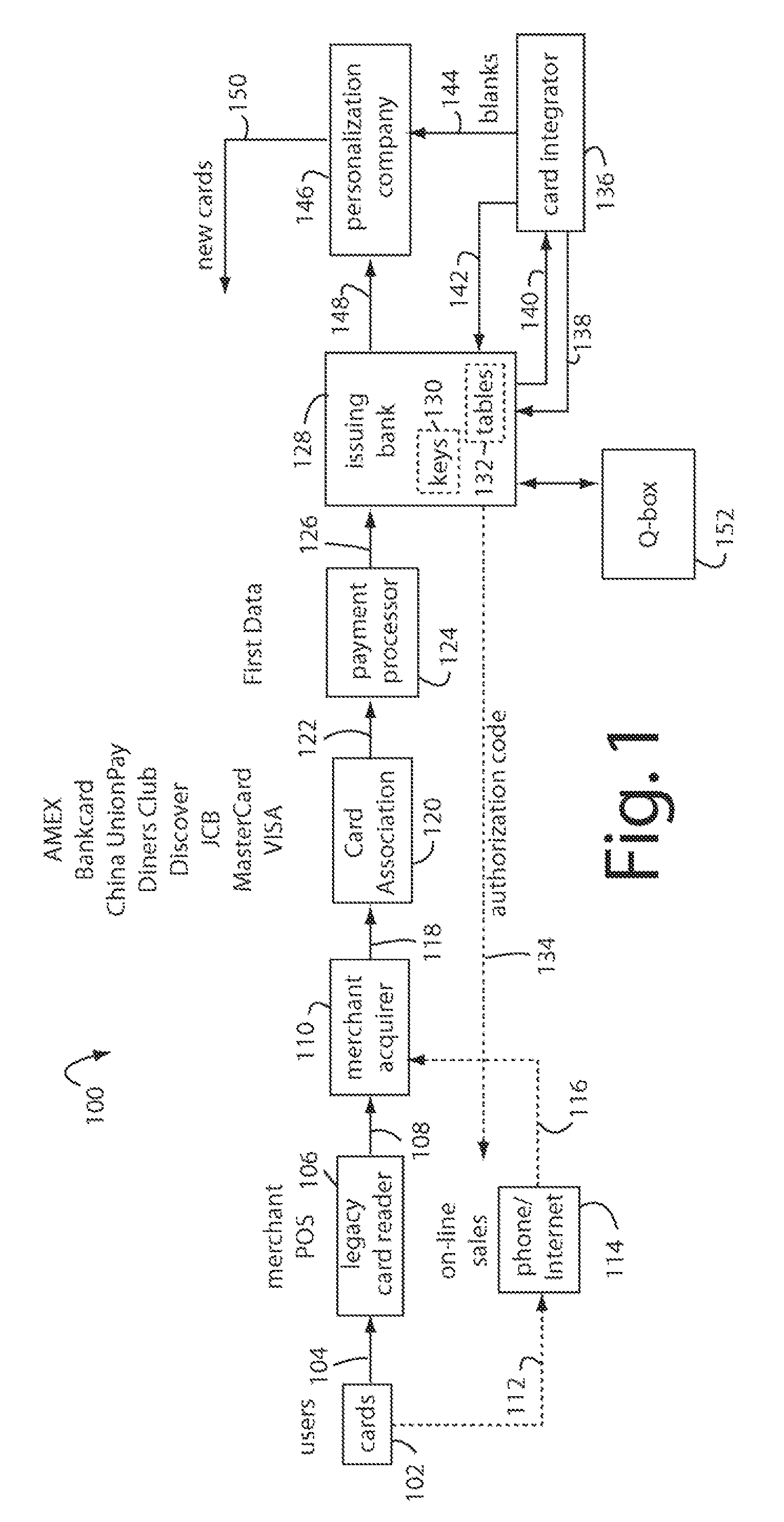

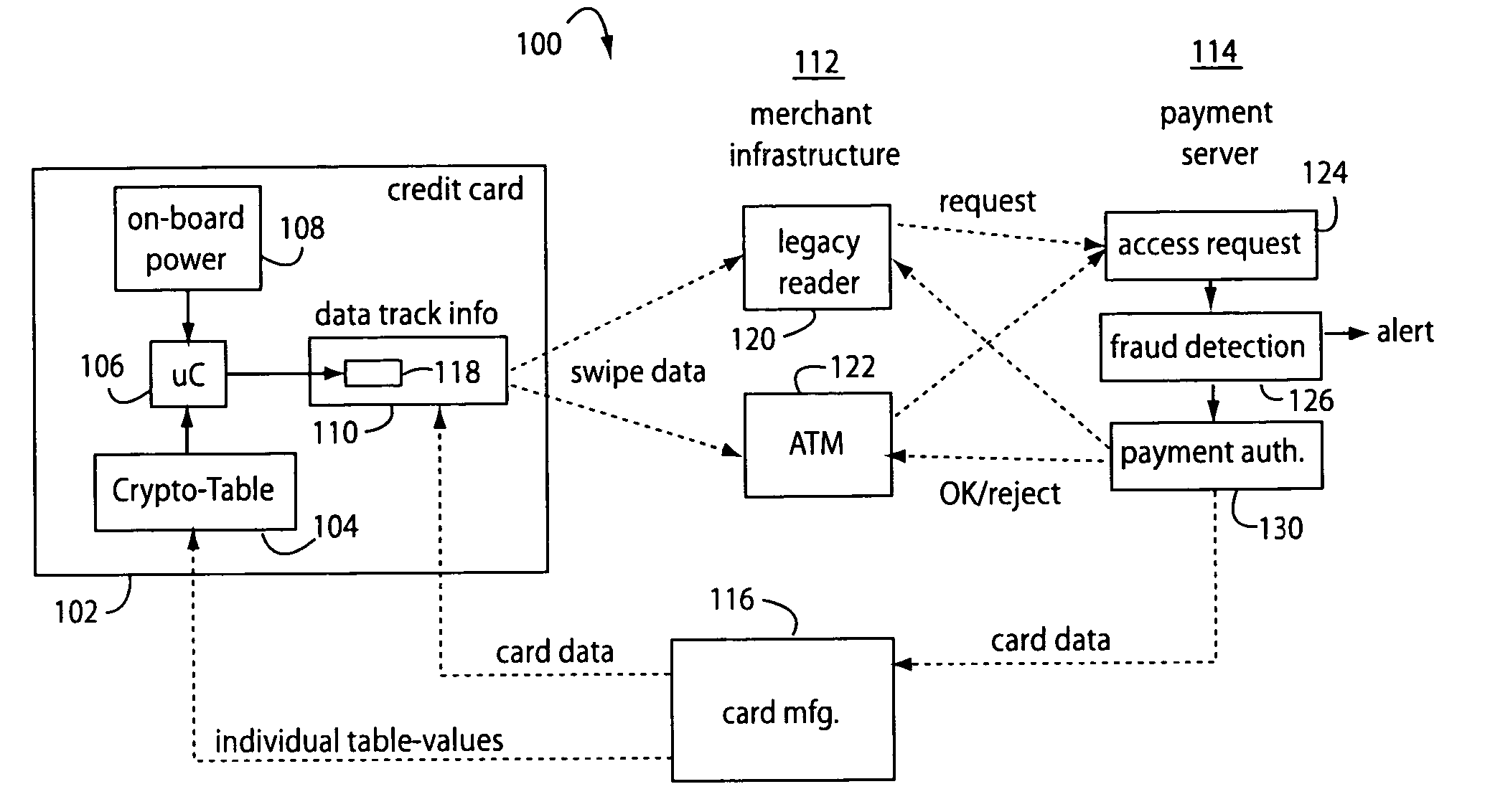

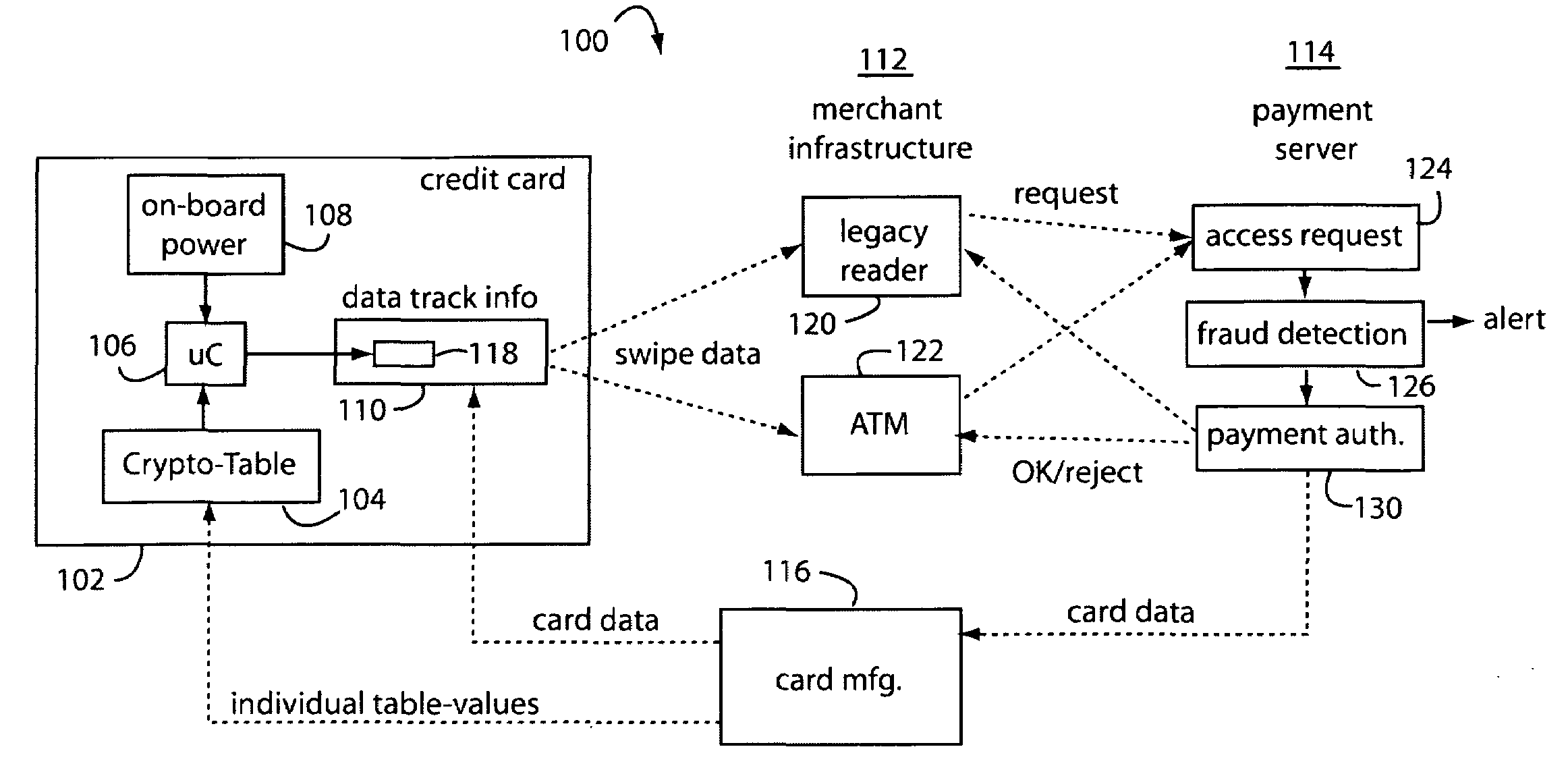

Financial transactions with dynamic personal account numbers

ActiveUS7580898B2Sufficient dataComputer security arrangementsPayment architecturePersonalizationIssuing bank

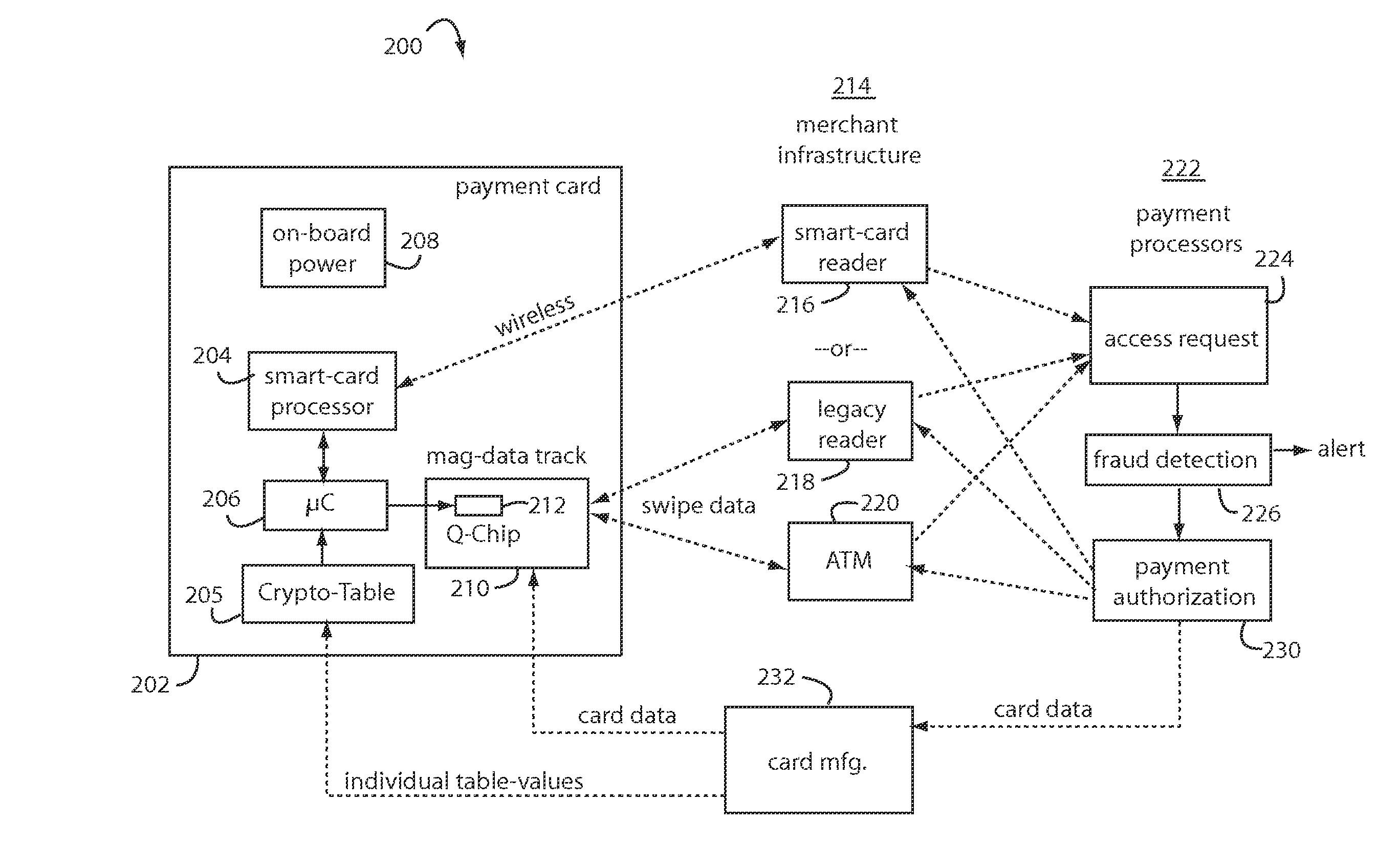

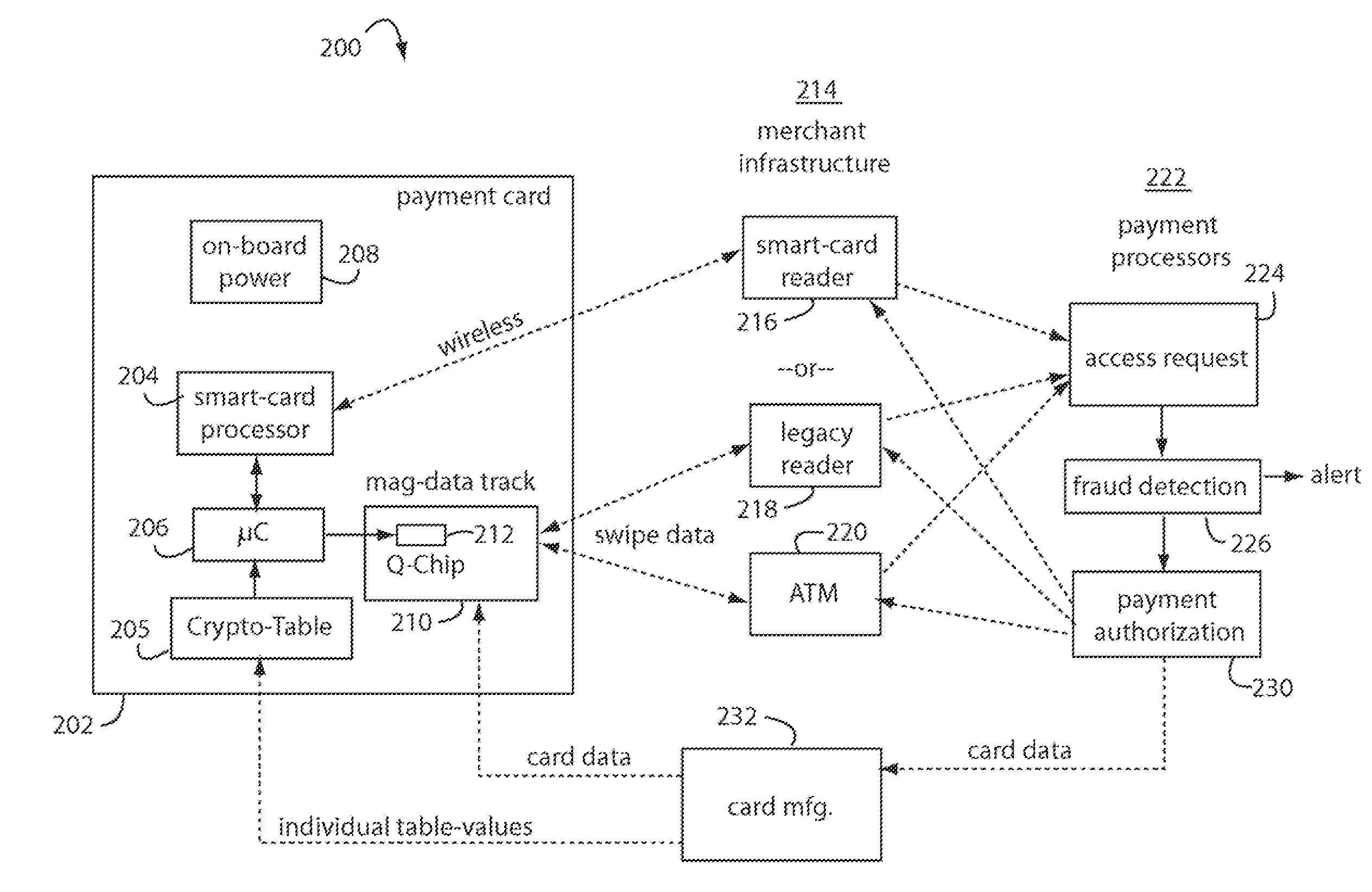

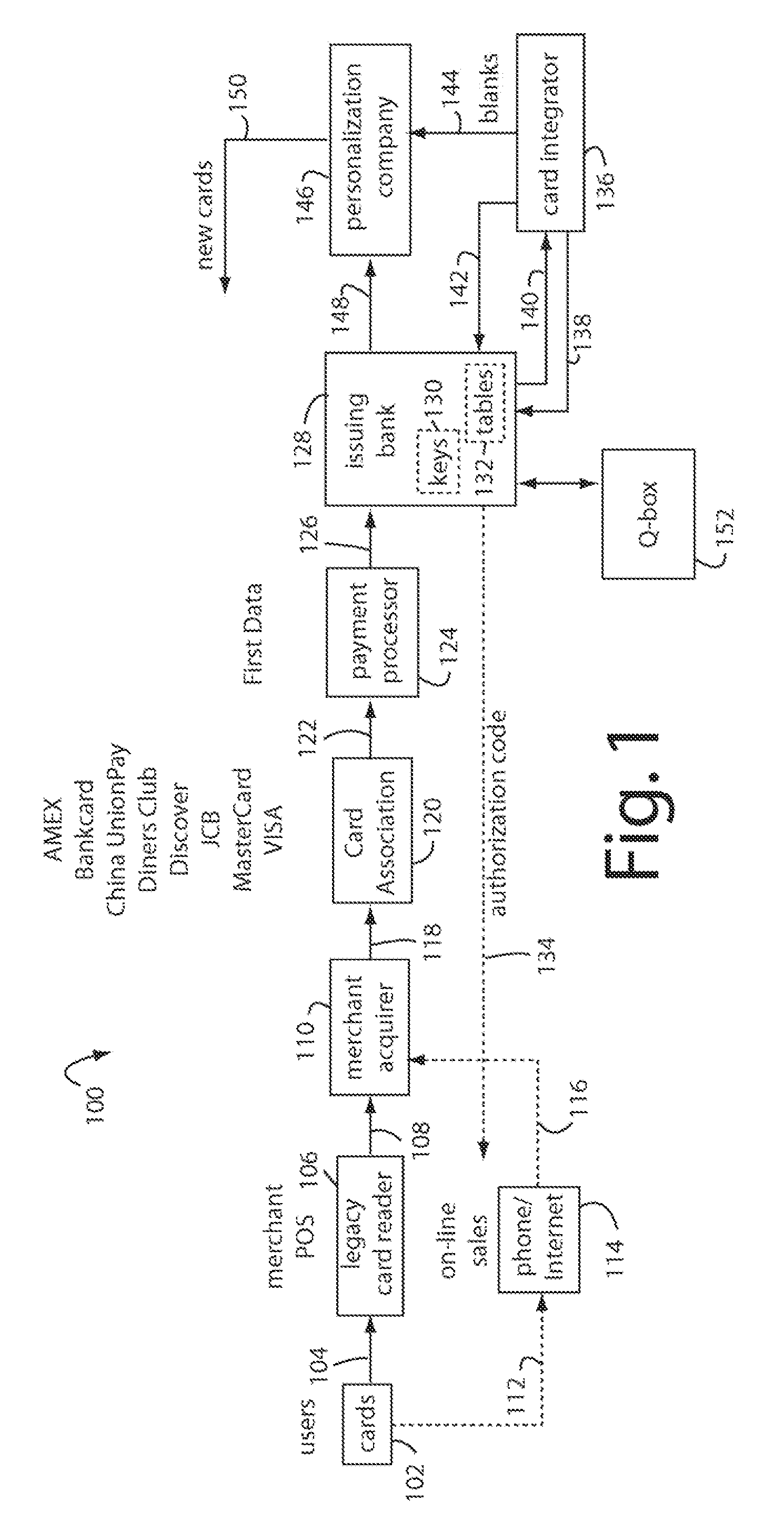

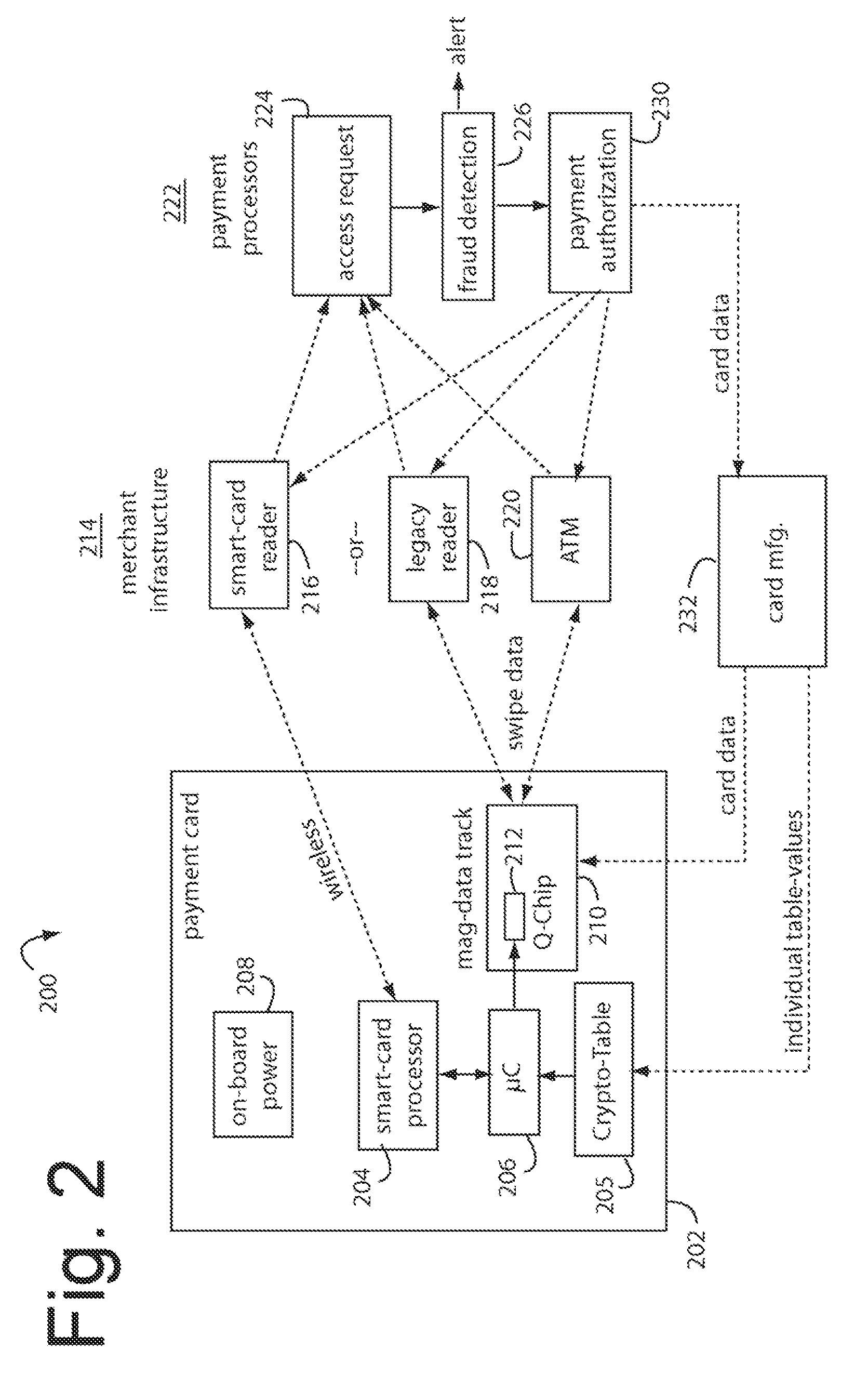

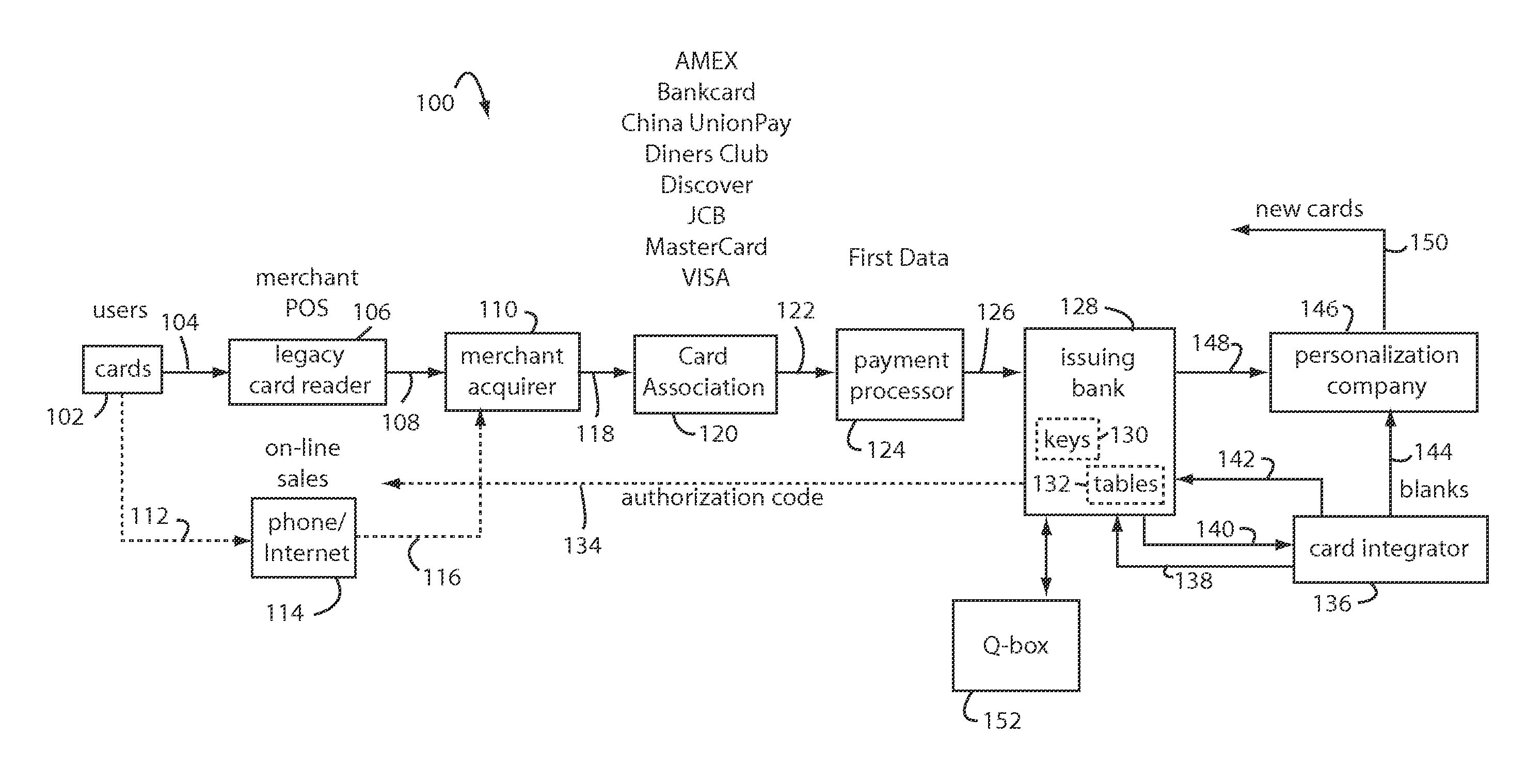

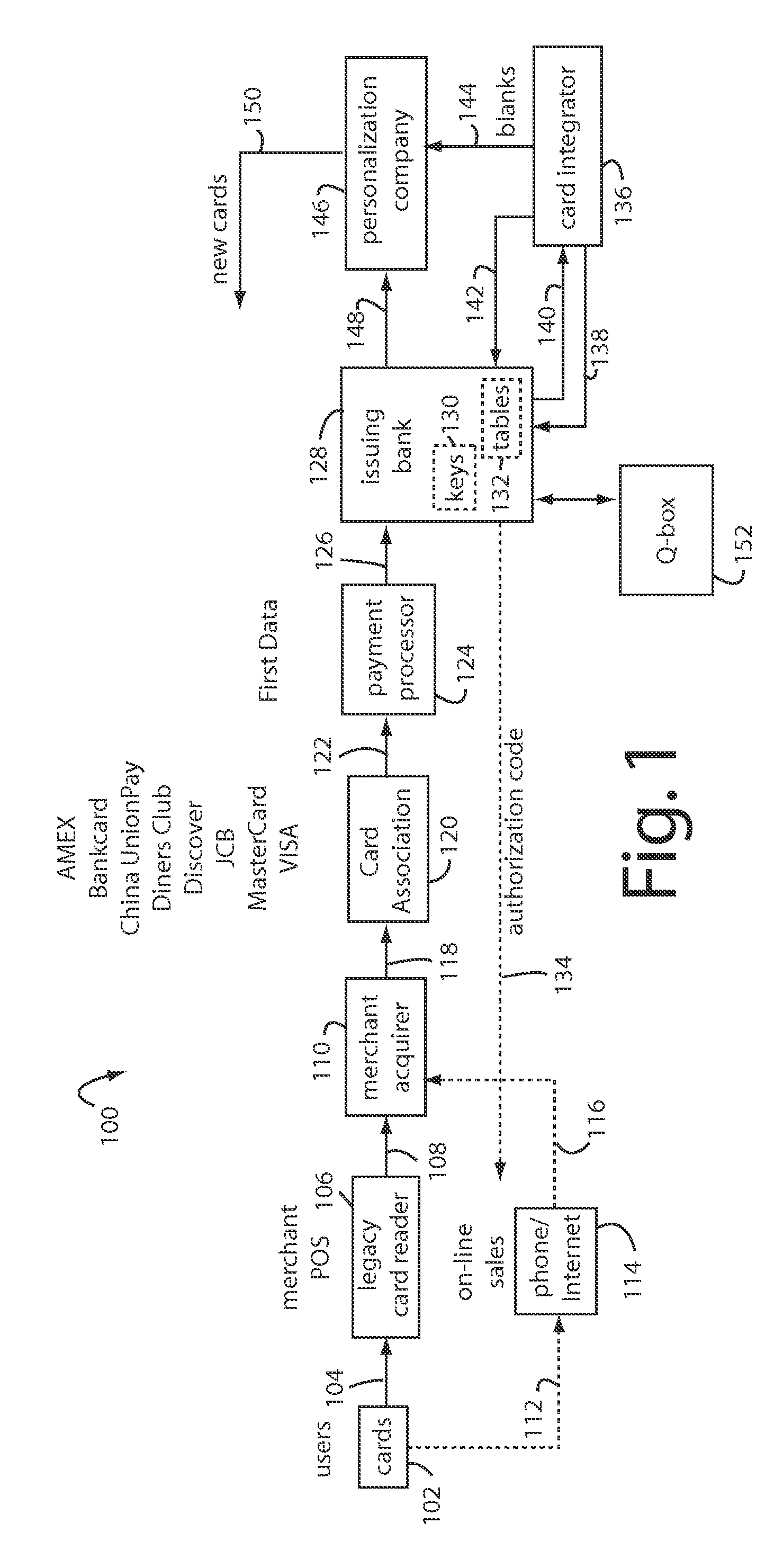

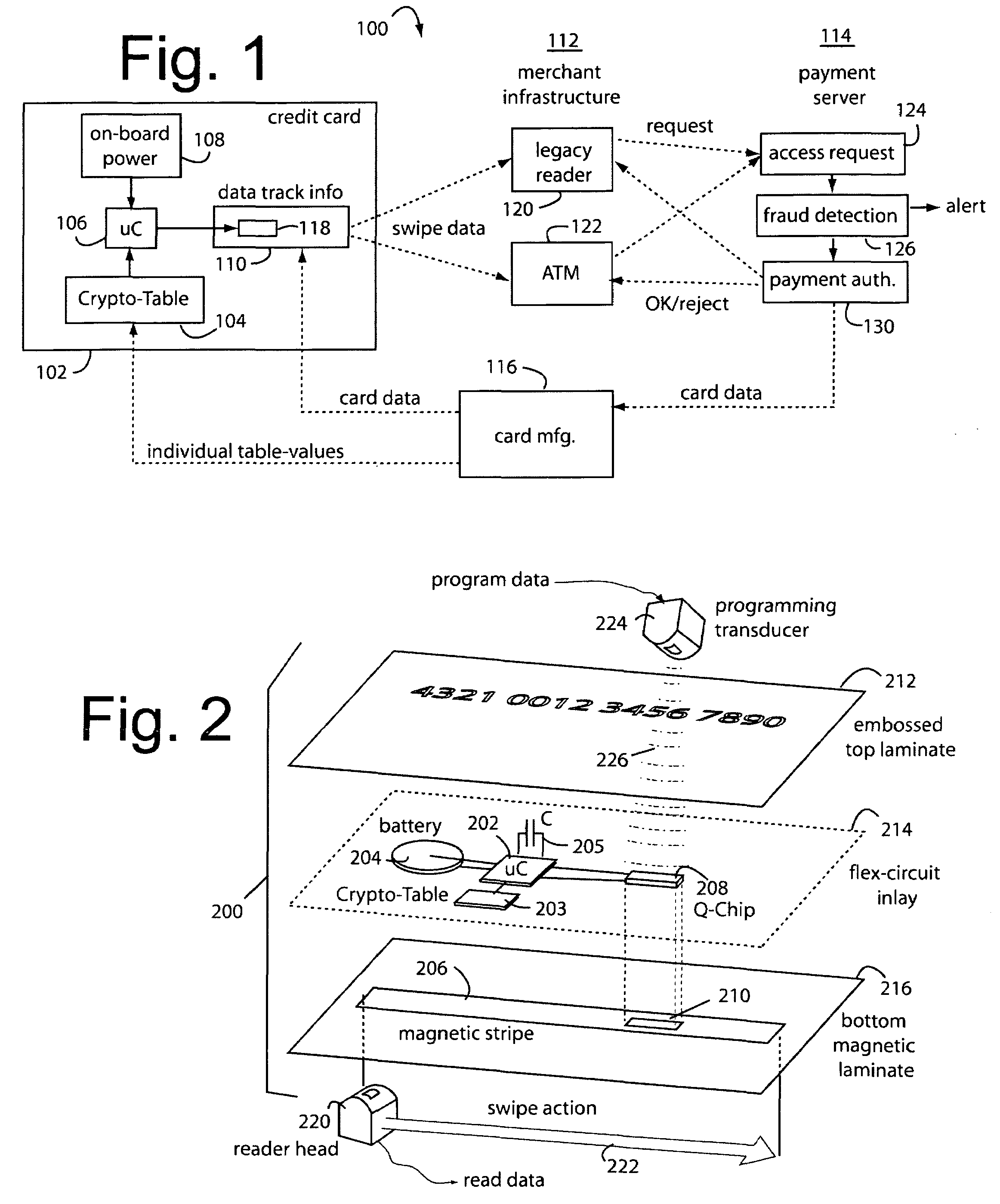

A method for securing financial transactions involving payment cards includes associating a sixteen-digit personal account number (PAN) with a particular payment card and user, wherein are included fields for a system number, a bank / product number, a user account number, and a check digit. A four-digit expiration date (MMYY) associated with the PAN. A magnetic stripe on the payment card is encoded with the PAN for periodic reading by a magnetic card reader during a financial transaction. A table of cryptographic values associated with the PAN and the MMYY is stored on each user's payment card during personalization by an issuing bank. A next financial transaction being commenced with the payment card is sensed. A cryptographic value from the table of cryptographic values is selected for inclusion as a dynamic portion of the user account number with the PAN when a next financial transaction is sensed. Any cryptographic value from the table of cryptographic values will not be used again in another financial transaction after being used once. The issuing bank authorizes the next financial transaction only if the PAN includes a correct cryptographic value in the user account number field.

Owner:FITBIT INC

Transaction apparatus and method

InactiveUS6315195B1Low production costEasy to operateHybrid readersPoint-of-sale network systemsComputer hardwareBarcode

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

Financial transactions with dynamic card verification values

ActiveUS20070136211A1Sufficient dataComputer security arrangementsPayment architectureUser needsPower user

A payment card comprises an internal dynamic card verification value (CVV) generator and a user display for card-not-present transactions. Card-present transactions with merchant card readers are enabled by a dynamic magnetic array internally associated with the card's magnetic stripe. The user display and a timer are triggered by the suer when the user needs to see the card verification value and / or begin a new transaction. A new card verification value is provided for each new transaction according to a cryptographic process, but the timer limits how soon a next new card verification value can be generated.

Owner:FITBIT INC

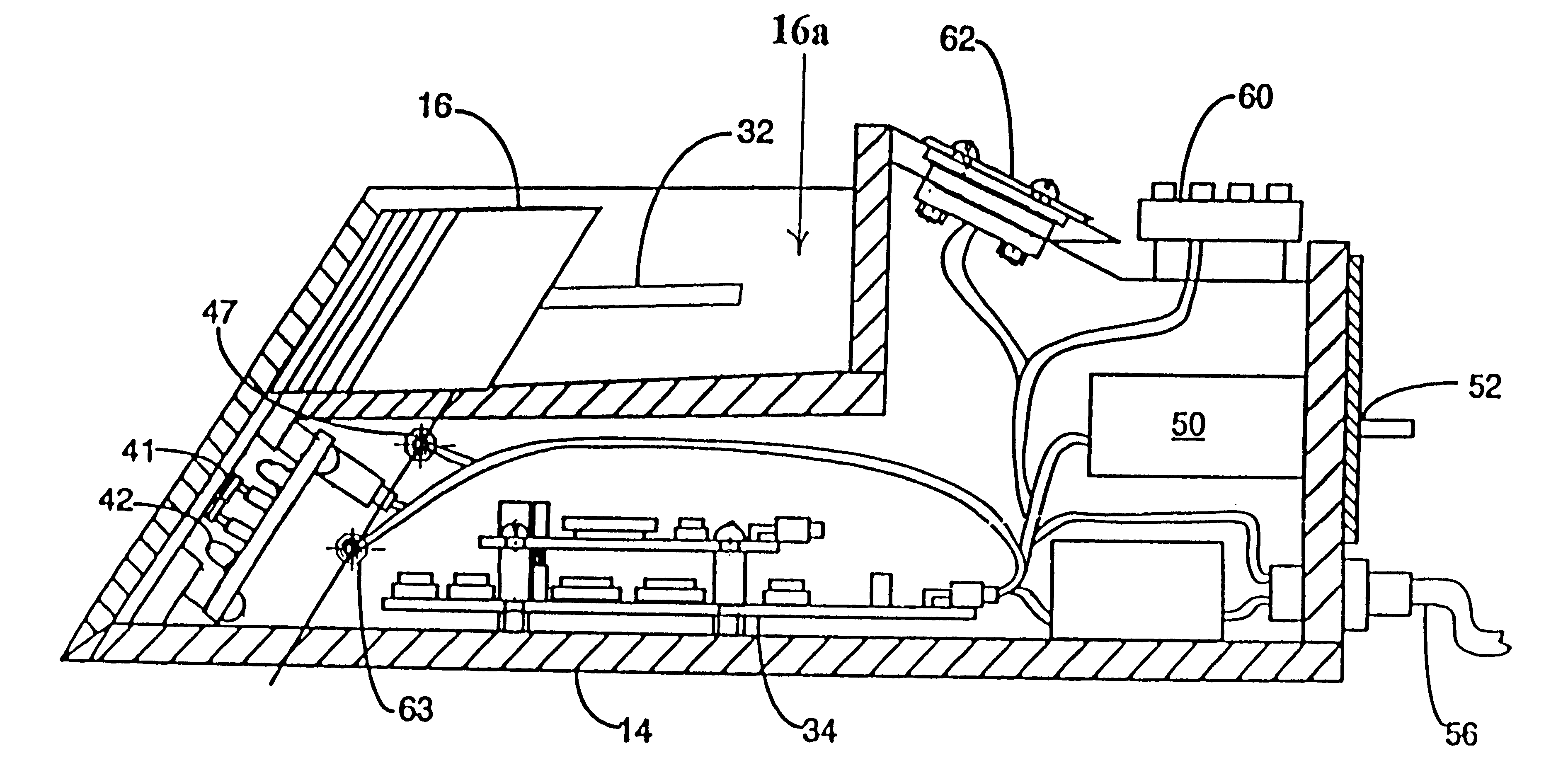

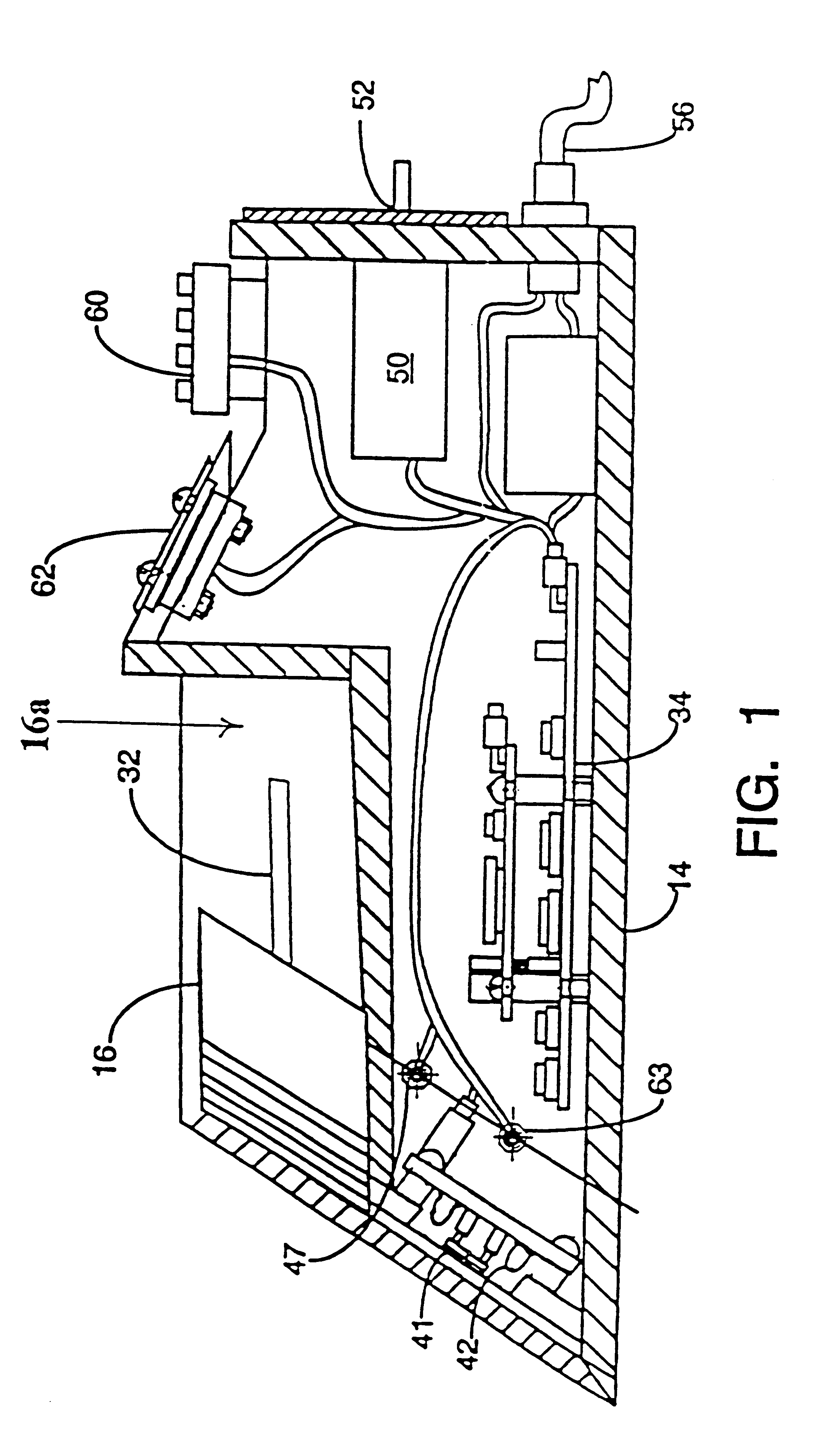

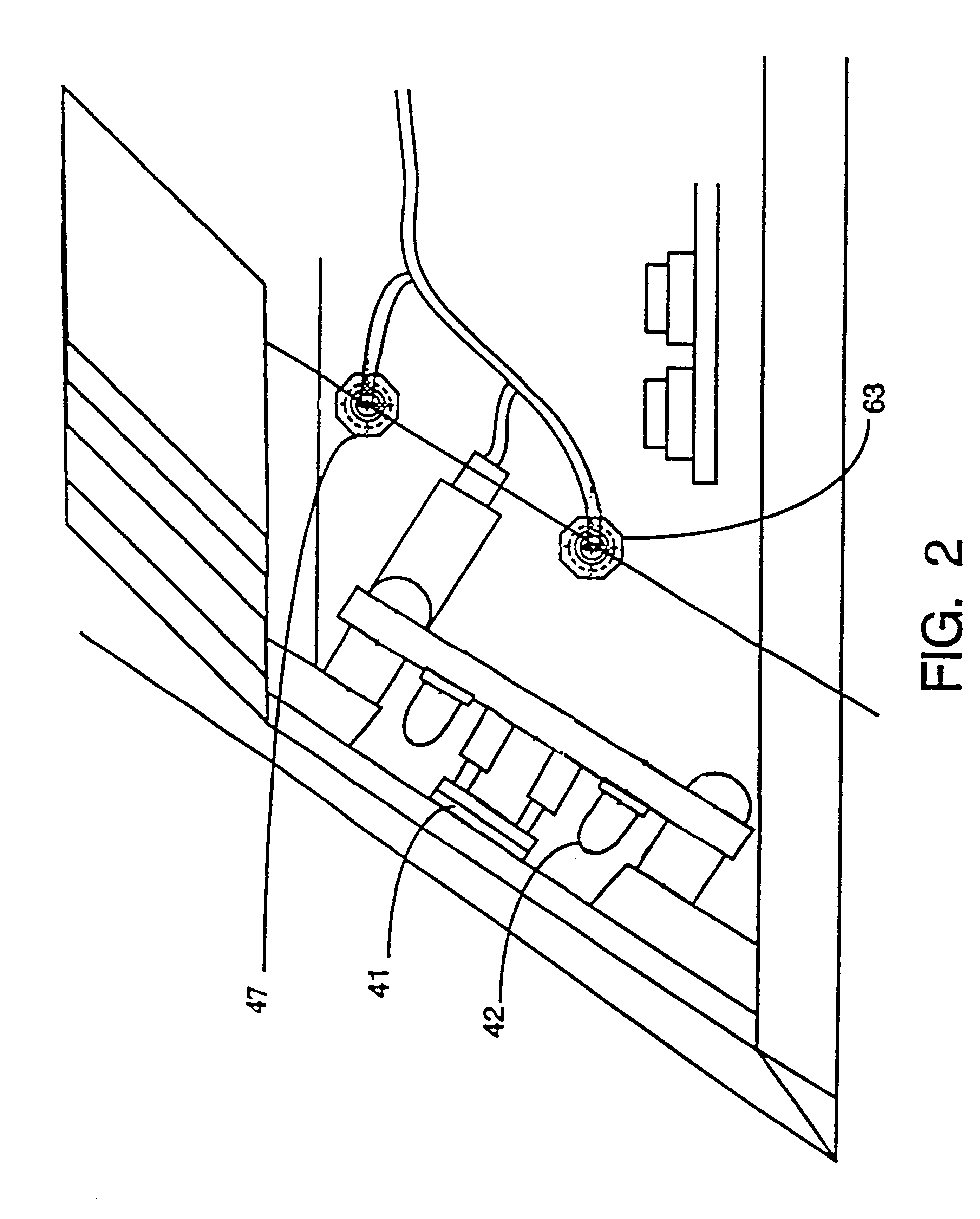

Card dispensing shoe with scanner apparatus, system and method therefor

The present invention is directed to a playing card dispensing shoe apparatus, system and method wherein the shoe has a card scanner which scans the indicia on a playing card as the card moves along and out of a chute of the shoe by operation of the dealer. The scanner comprises an optical-sensor used in combination with a neural network which is trained using error back-propagation to recognize the card suits and card values of the playing cards as they are moved past the scanner. The scanning process in combination with a central processing unit (CPU) determines the progress of the play of the game and, by identifying card counting systems or basic playing strategies in use by the players of the game, provides means to limit or prevent casino losses and calculate the Theoretical Win of the casino, thus also providing an accurate quality method of the amount of comps to be given a particular player. The shoe is also provided with additional devices which make it simple and easy to access, record and display other data relevant to the play of the game. These include means for acconunodating a "customer-tracking card" which reads each player's account information from a magnetic stripe on the card, thus providing access to the player's customer data file stored on the casino's computer system, and one or more alpha-numeric keyboards and LCD displays used to enter and retrieve player and game information. Also included are keyboards on the game table so that each player can individually select various playing or wagering options using their own keyboard.

Owner:PROGRESSIVE GAMING INT

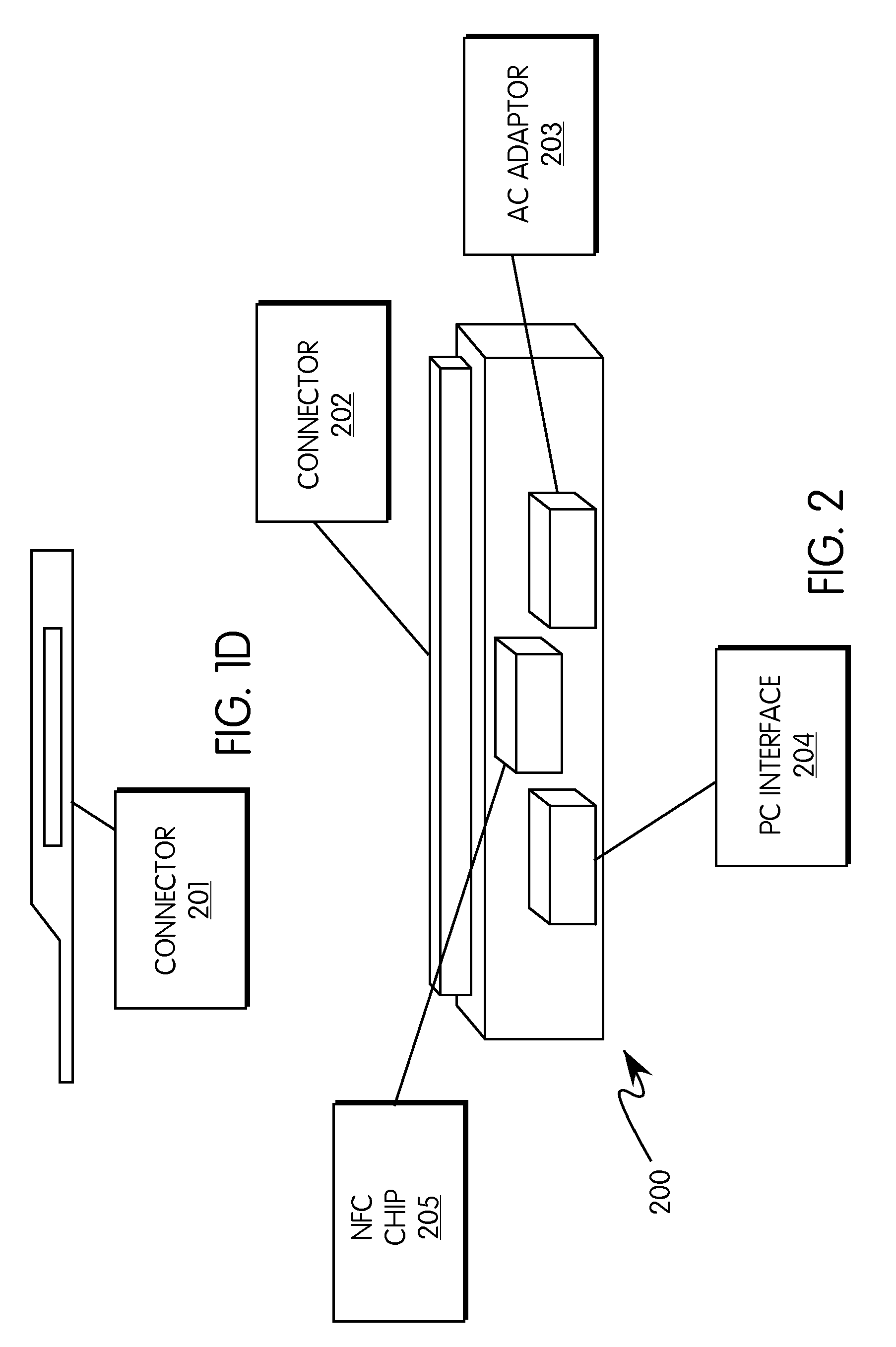

Multi-account card with magnetic stripe data and electronic ink display being changeable to correspond to a selected account

A multifunction card includes a programmable memory, a magnetic stripe, and an electronic ink display. The programmable memory is able to store corresponding account data and image data for a plurality of different accounts. The card holder is able to use a portable terminal to select one of the accounts stored in memory. The terminal is able to write account data corresponding to the selected account to the magnetic stripe of the card. The terminal is also able to electronically change the electronic ink display to the image corresponding to the selected account. Thus, a single multifunction card, with the ability to have both its magnetic stripe data and appearance changed in accordance with a selected account, can substitute for many different cards.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

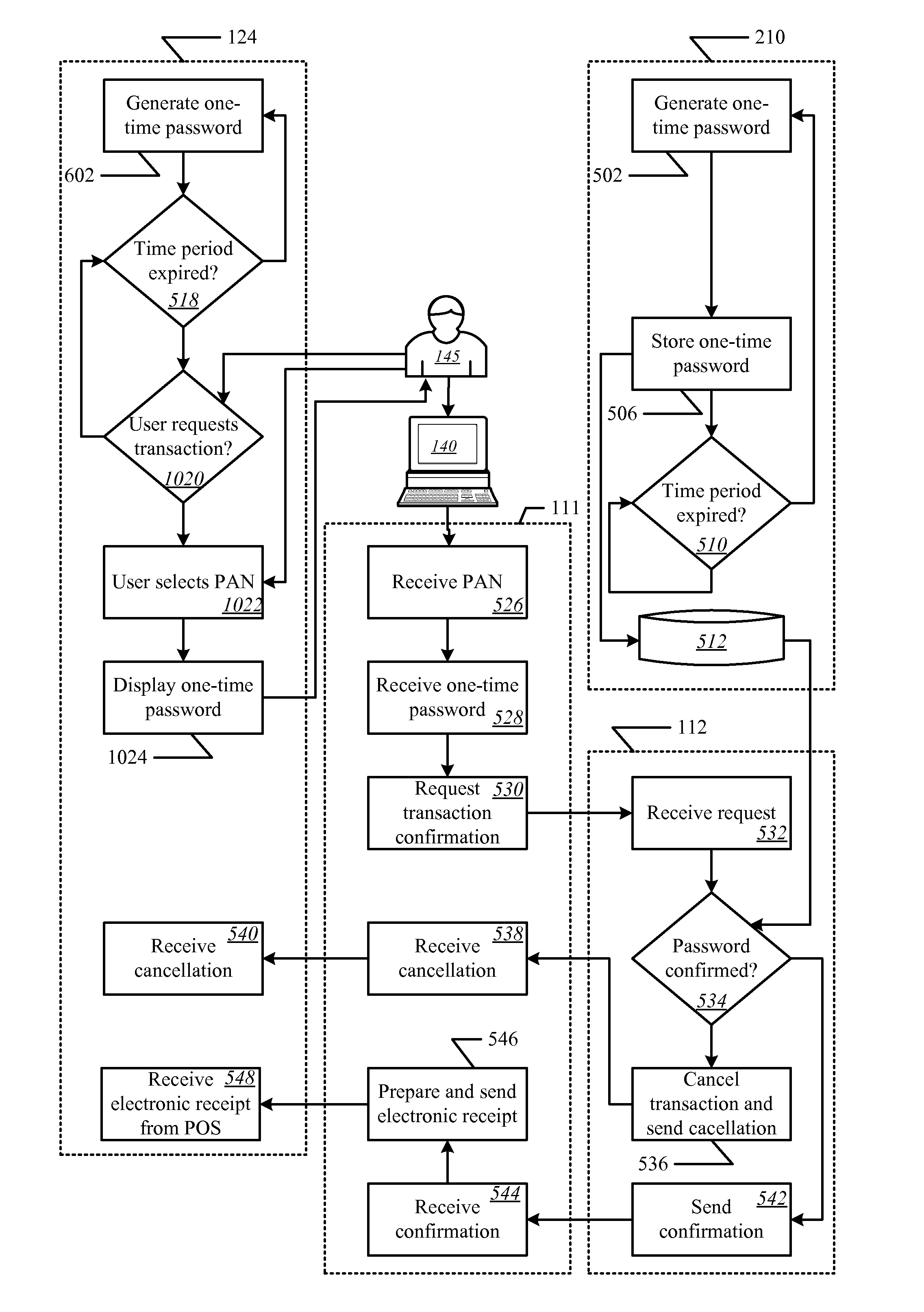

Onetime passwords for smart chip cards

ActiveUS8095113B2Unauthorised/fraudulent call preventionEavesdropping prevention circuitsDisplay deviceFinancial transaction

A financial transaction card is provided according to various embodiments described herein. The financial transaction card includes a card body with at least a front surface and a back surface. The financial transaction card may also include a near field communications transponder and / or a magnetic stripe, as well as a digital display configured to display alphanumeric characters on the front surface of the card body. The financial transaction card may also include a processor that is communicatively coupled with the near field communications transponder or magnetic stripe and the digital display. The processor may be configured to calculate one-time passwords and communicate the one-time passwords to both the near filed communications transponder or magnetic stripe and the digital display.

Owner:FIRST DATA

Automated payment card fraud detection and location

A payment card fraud detection business model comprises an internal virtual account number generator and a user display for Card-Not-Present transactions. Card-Present transactions with merchant card readers are enabled by a magnetic array internally associated with the card's magnetic stripe. The internal virtual account number generator is able to reprogram some of the magnetic bits encoded in the magnetic stripe to reflect the latest virtual account number. The internal virtual account number generator produces a sequence of virtual numbers that can be predicted and approved by the issuing bank. Once a number is used, such is discarded and put on an exclusion list or reserved for a specific merchant until the expiration date. A server for the issuing bank logs the merchant locations associated with each use or attempted use, and provides real-time detection of fraudulent attempts to use a virtual account number on the exclusion list. Law enforcement efforts can then be directed in a timely and useful way not only where the fraud occurs but also at its origination.

Owner:FITBIT INC

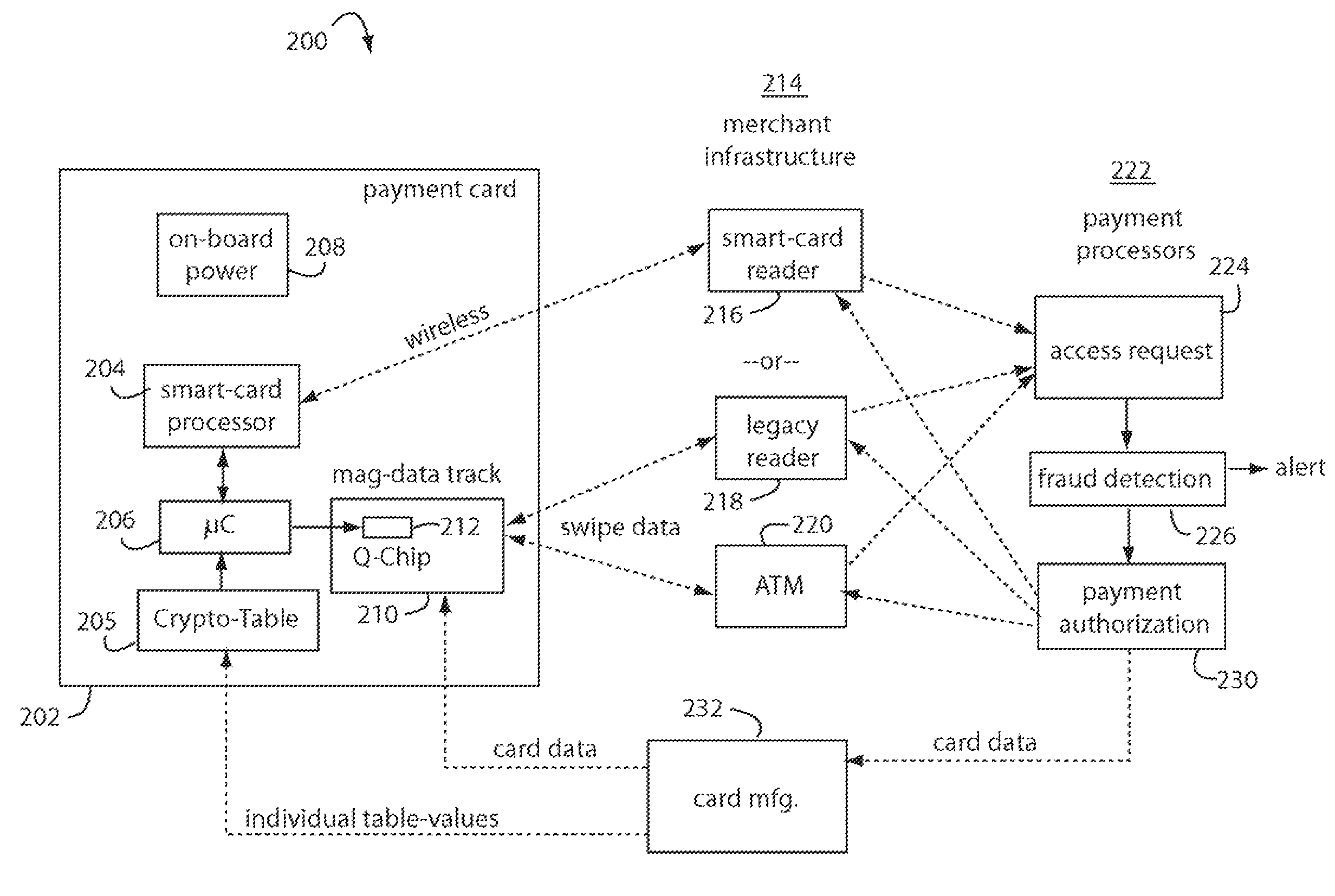

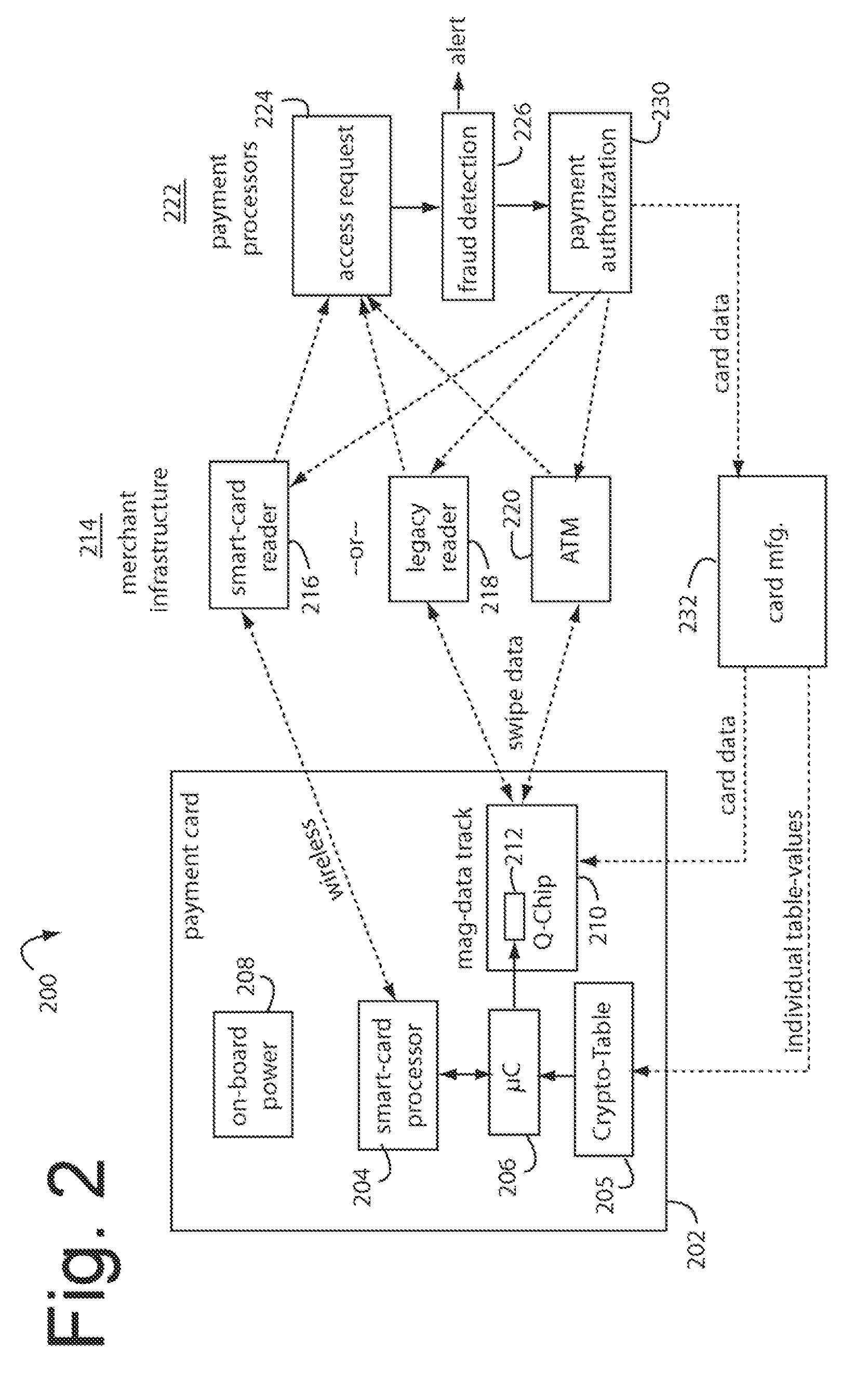

Financial transactions with dynamic personal account numbers

ActiveUS20070208671A1Sufficient dataComputer security arrangementsPayment architecturePersonalizationIssuing bank

A method for securing financial transactions involving payment cards includes associating a sixteen-digit personal account number (PAN) with a particular payment card and user, wherein are included fields for a system number, a bank / product number, a user account number, and a check digit. A four-digit expiration date (MMYY) associated with the PAN. A magnetic stripe on the payment card is encoded with the PAN for periodic reading by a magnetic card reader during a financial transaction. A table of cryptographic values associated with the PAN and the MMYY is stored on each user's payment card during personalization by an issuing bank. A next financial transaction being commenced with the payment card is sensed. A cryptographic value from the table of cryptographic values is selected for inclusion as a dynamic portion of the user account number with the PAN when a next financial transaction is sensed. Any cryptographic value from the table of cryptographic values will not be used again in another financial transaction after being used once. The issuing bank authorizes the next financial transaction only if the PAN includes a correct cryptographic value in the user account number field.

Owner:FITBIT INC

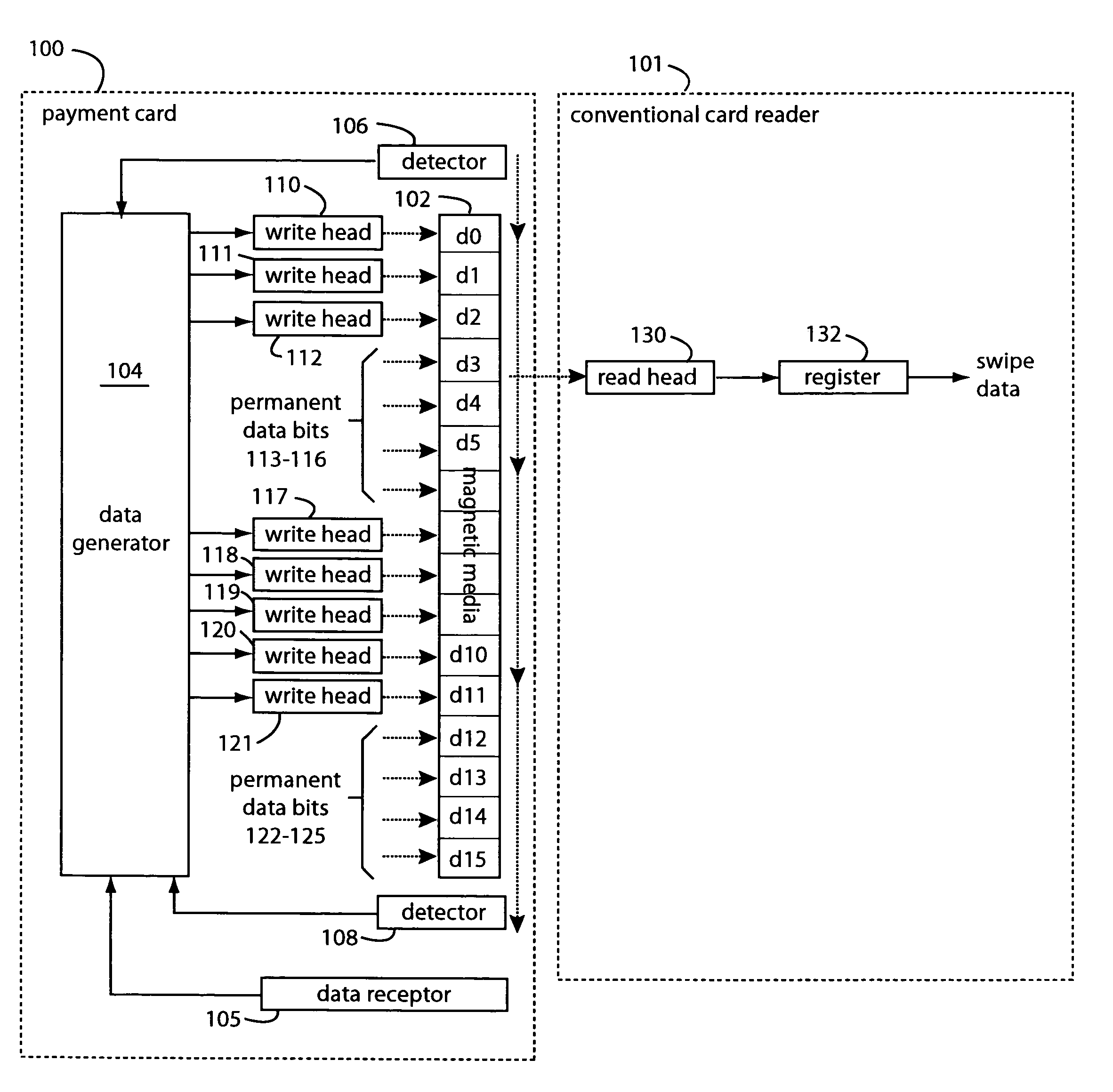

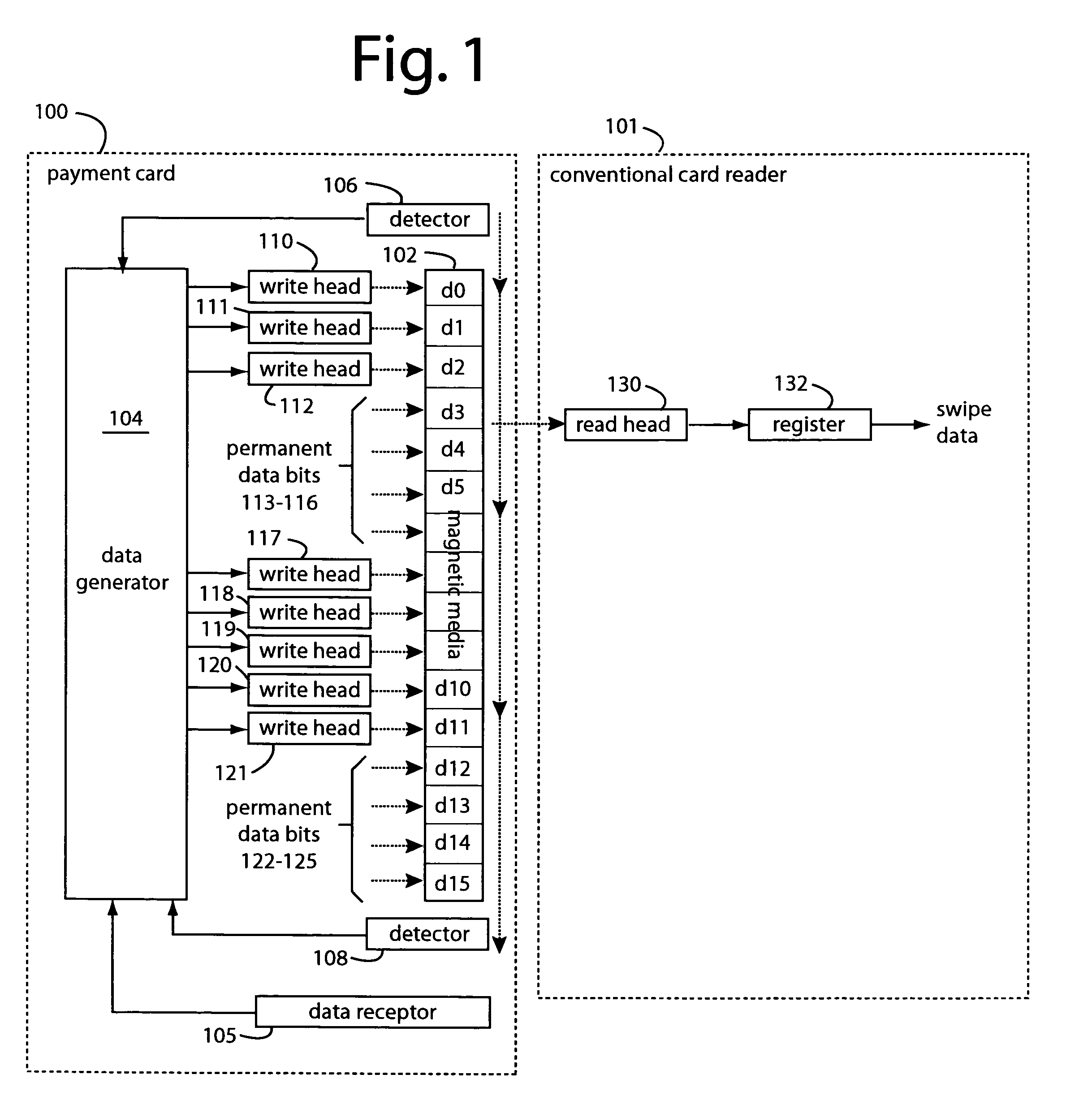

Payment card preloaded with unique numbers

ActiveUS7380710B2Reduce financial riskSimple and inexpensive and effectiveFinancePayment architectureFinancial transactionPayment order

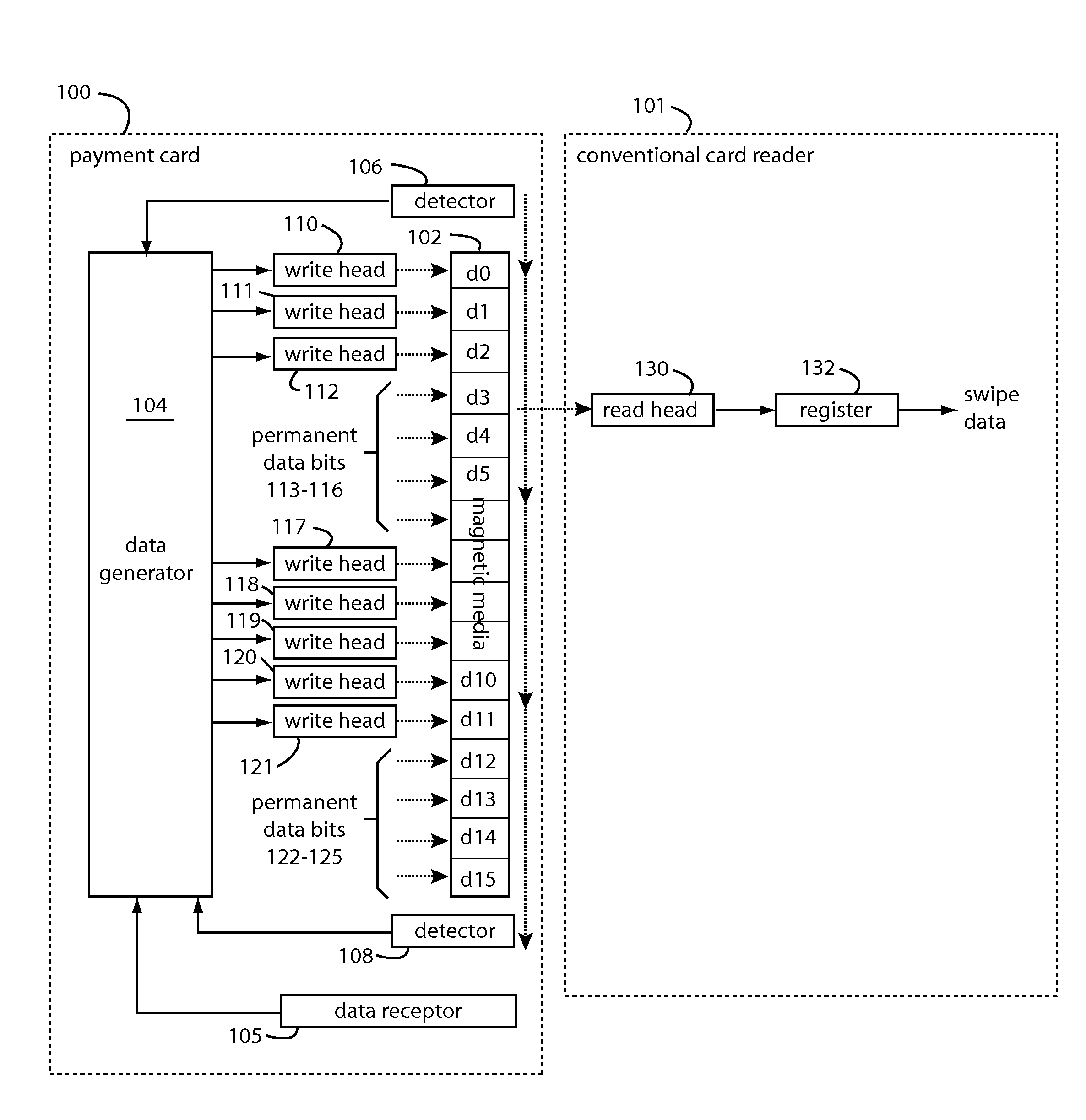

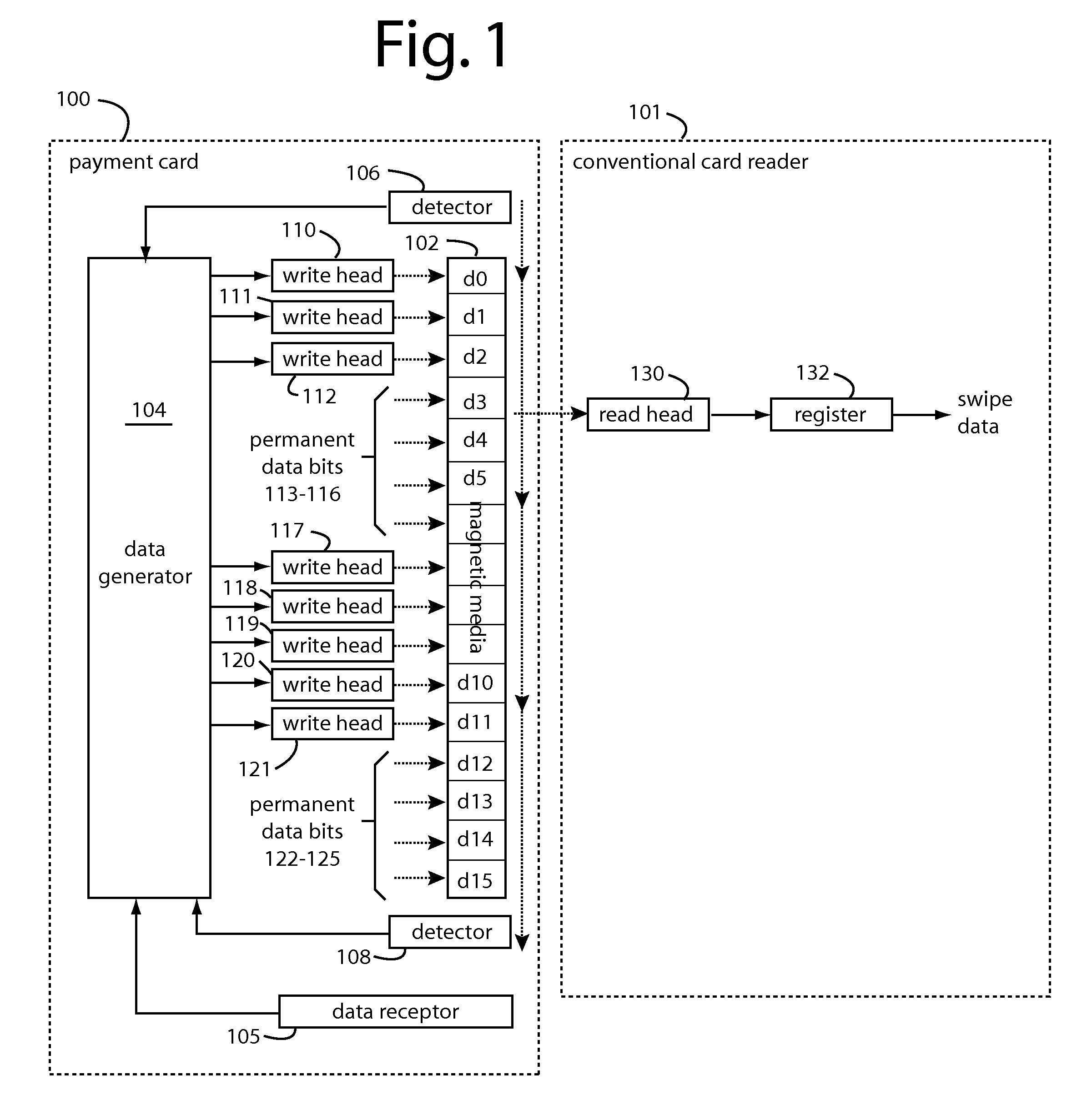

A conventional looking payment card comprises a plastic card with a legacy card reader compatible magnetic stripe for dynamic user account data. Internal to the plastic card, and behind the magnetic stripe, a number of fixed-position magnetic write heads allow the user account data to be modified autonomously. Electronics within the card are pre-loaded with many unique numbers that are selected for one-time use in financial transactions. A payment processing center keeps track of the unique numbers used, and knows which numbers to expect in future transactions. It will not authorize transaction requests if the unique number read during a magnetic card swipe is not as expected. A card-swipe detector embedded in the plastic card detects each use in a scanner, so changes can be made to the data bits sent to the write heads.

Owner:FITBIT INC

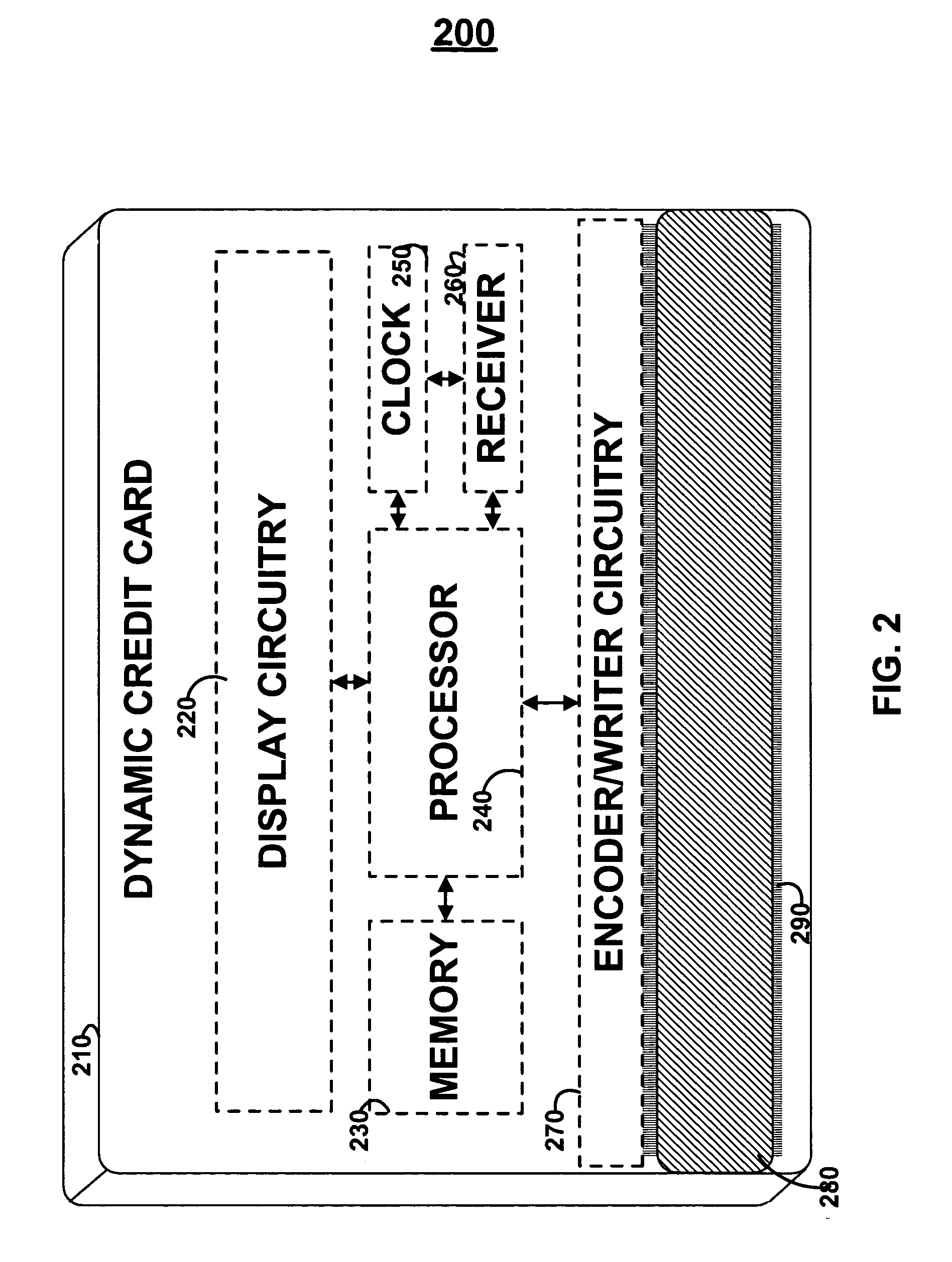

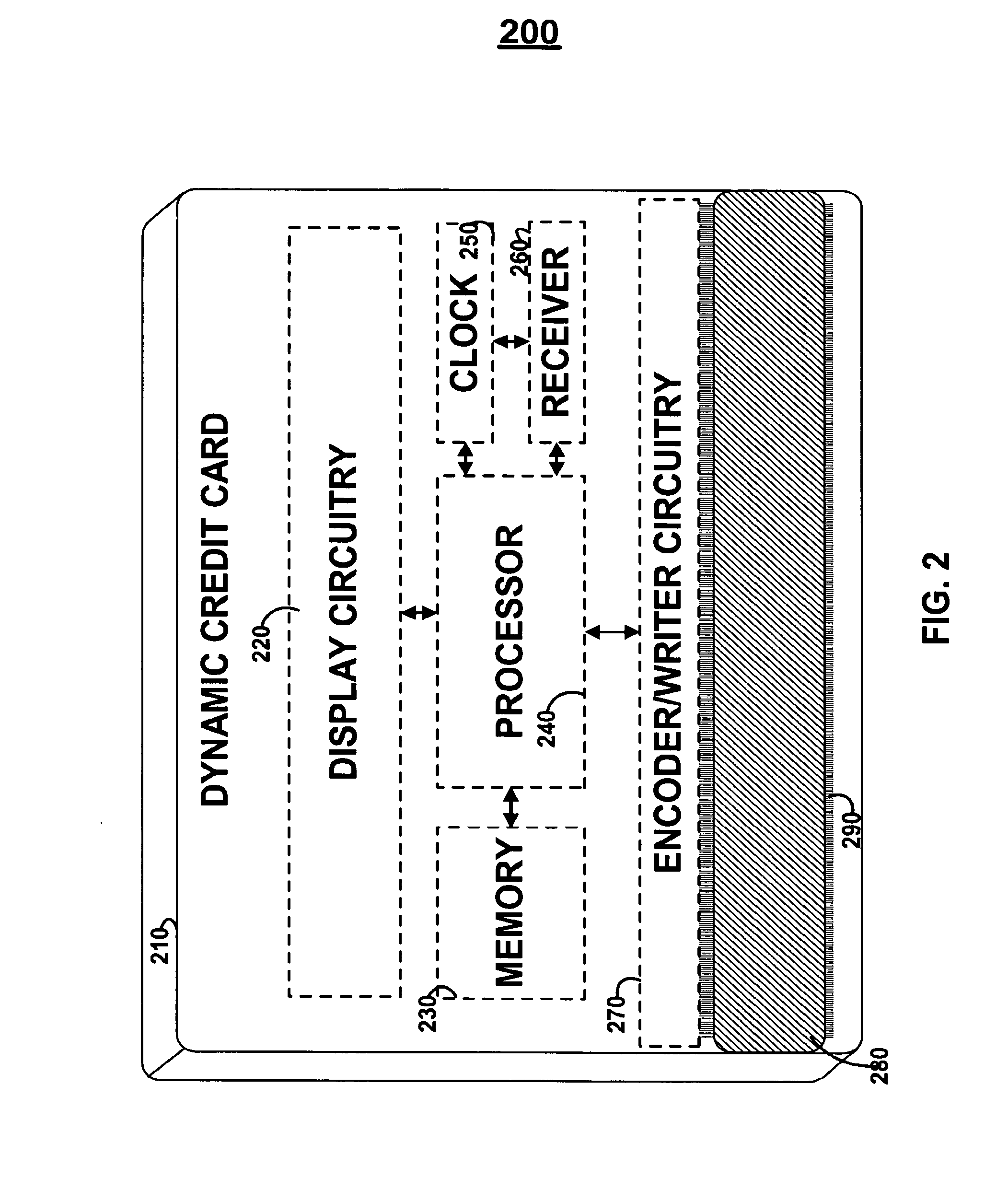

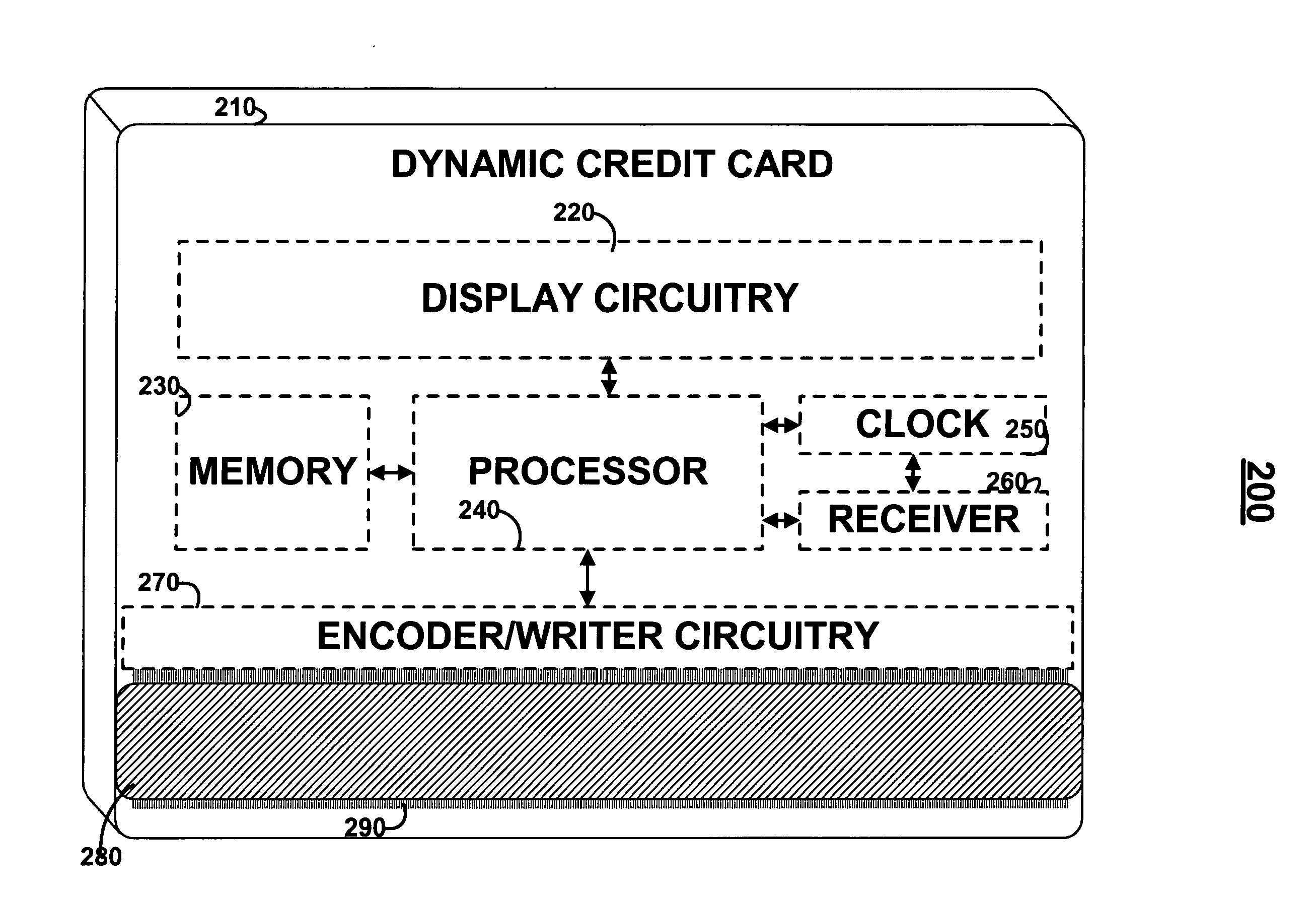

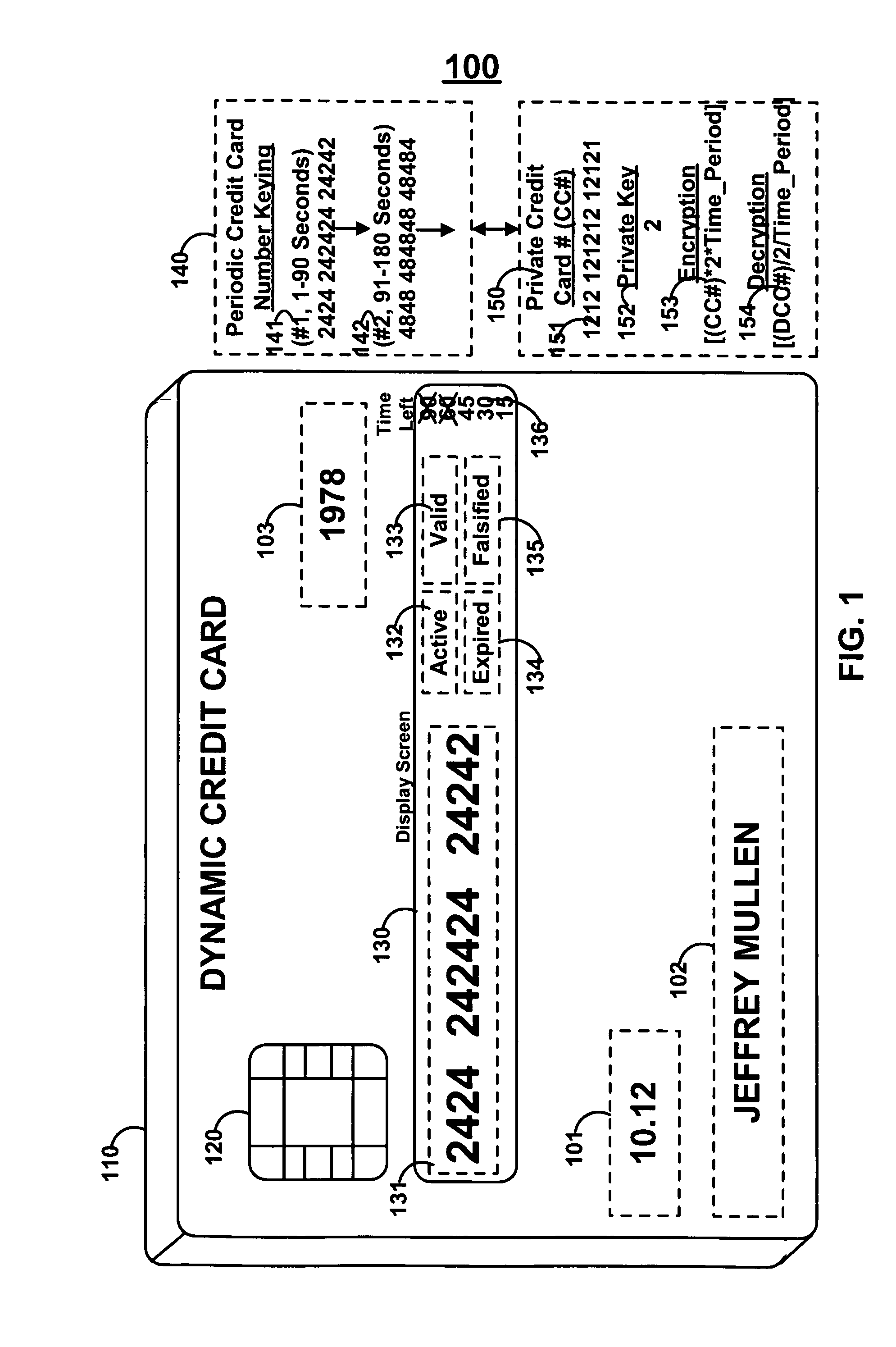

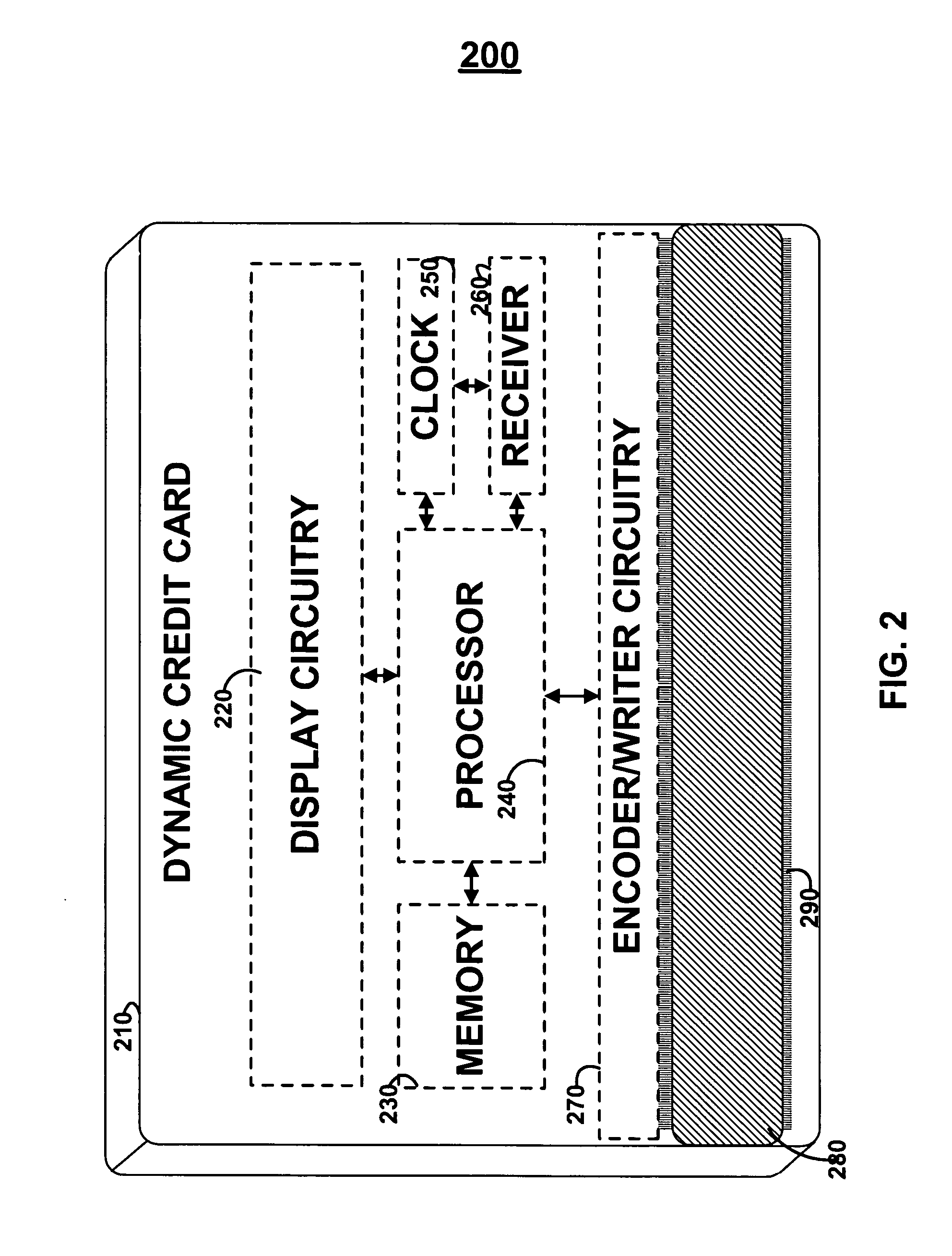

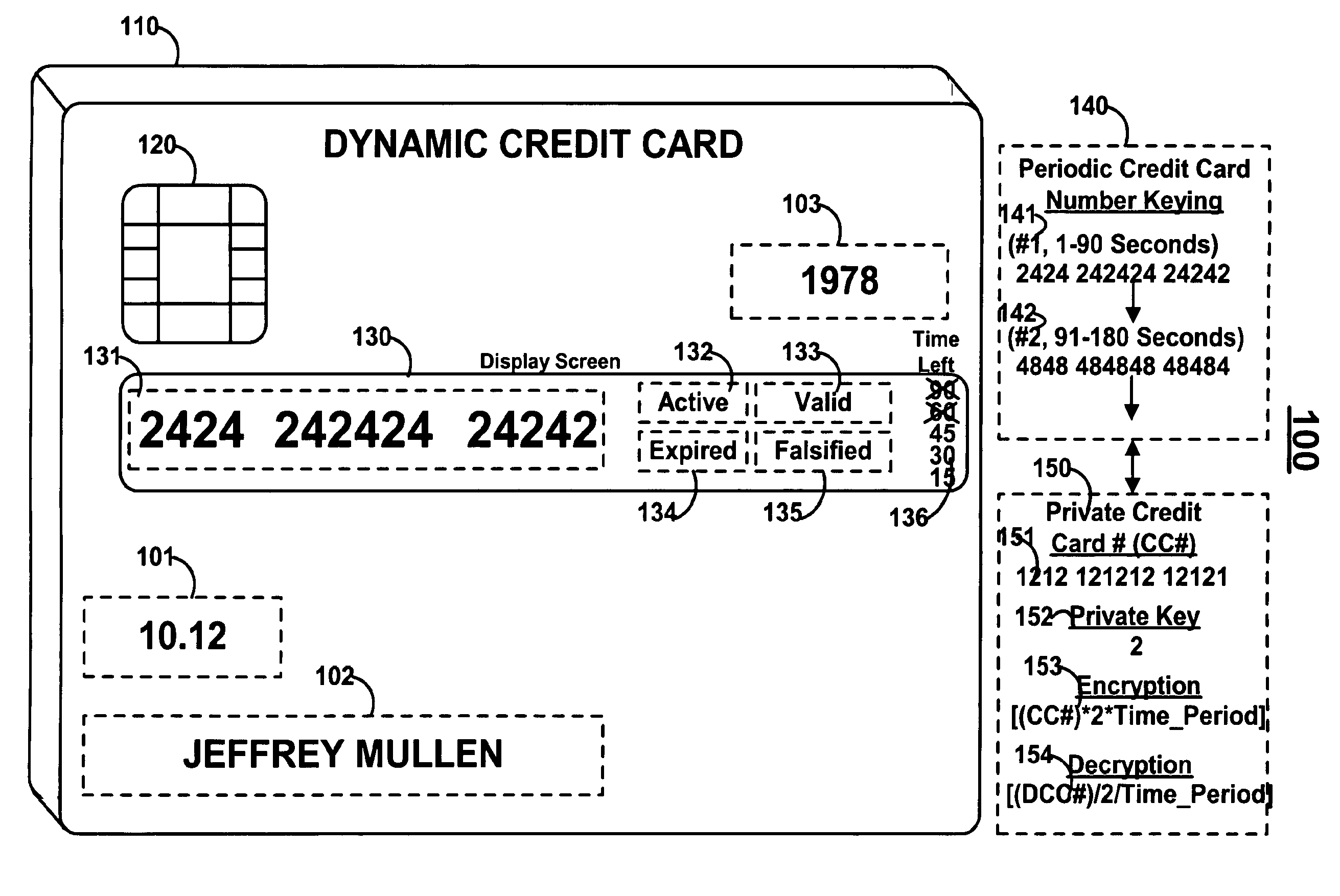

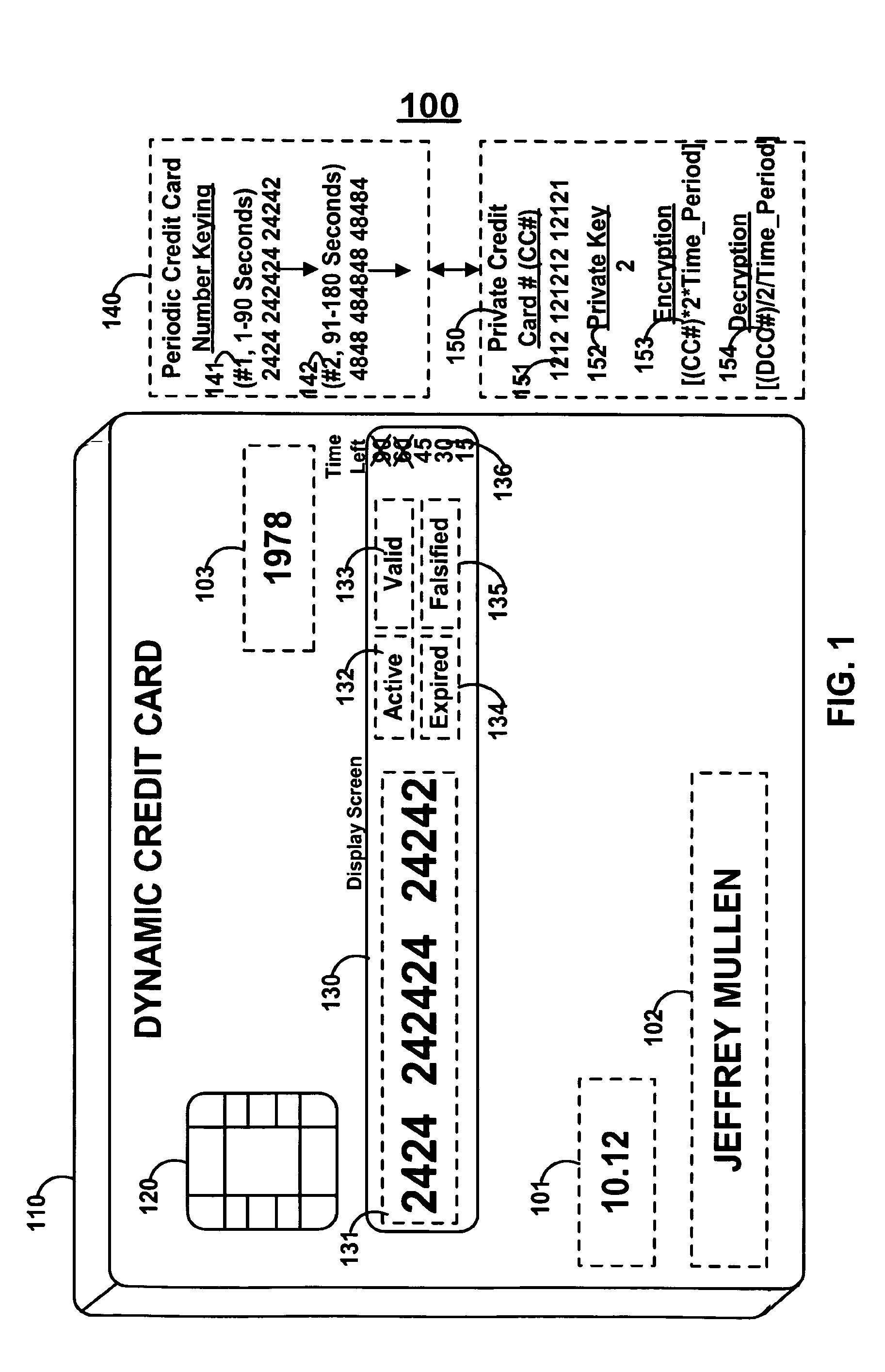

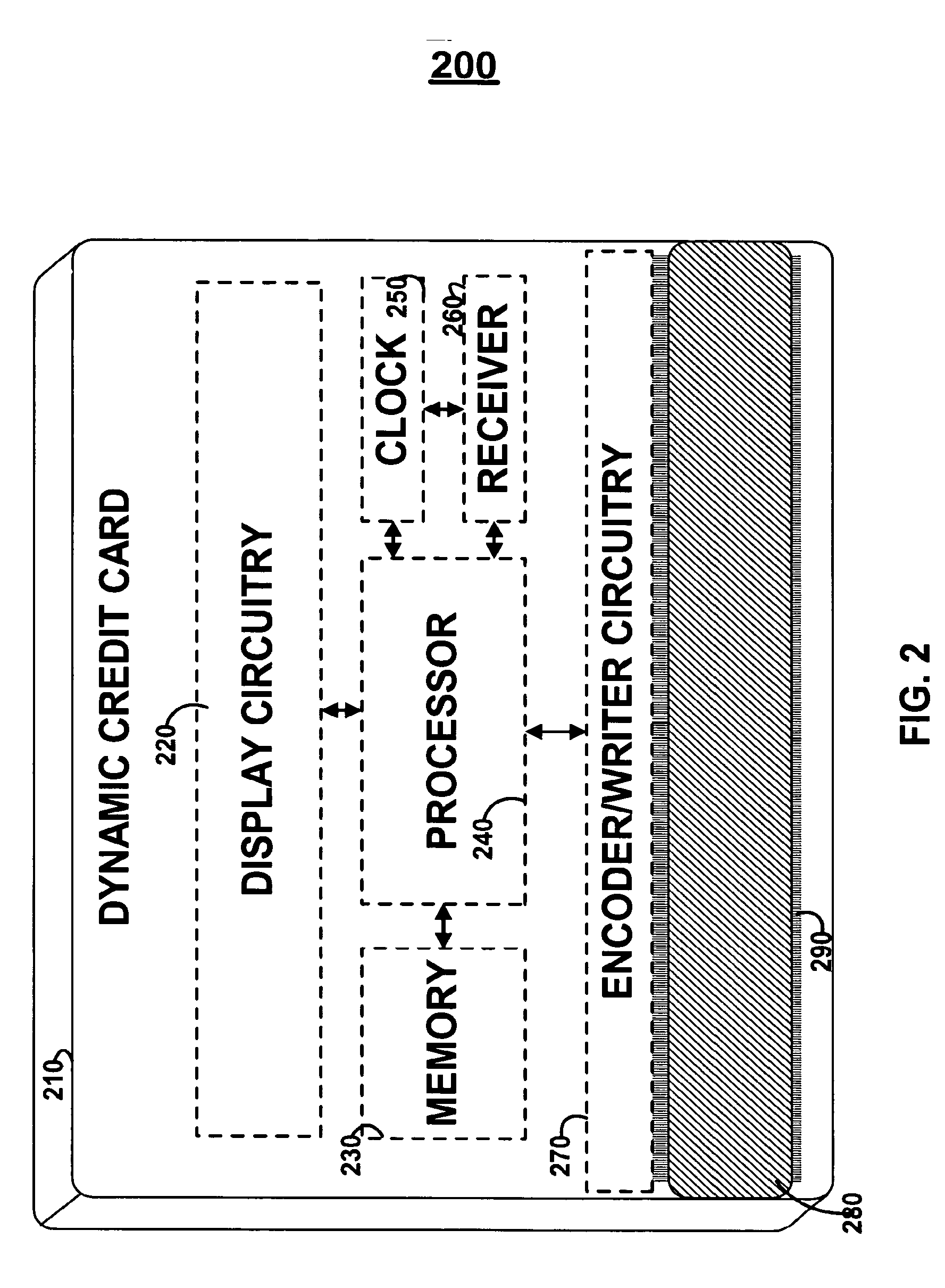

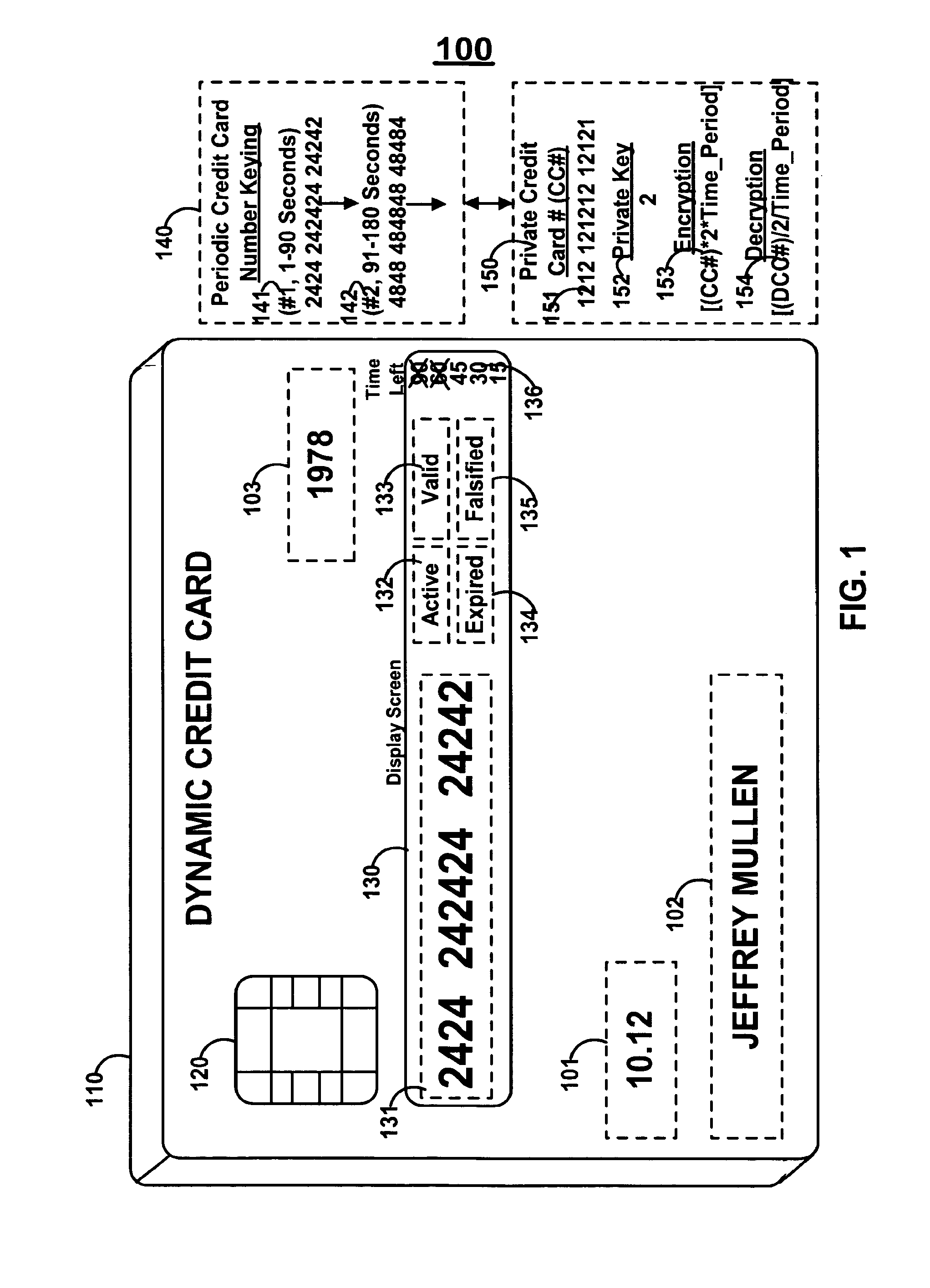

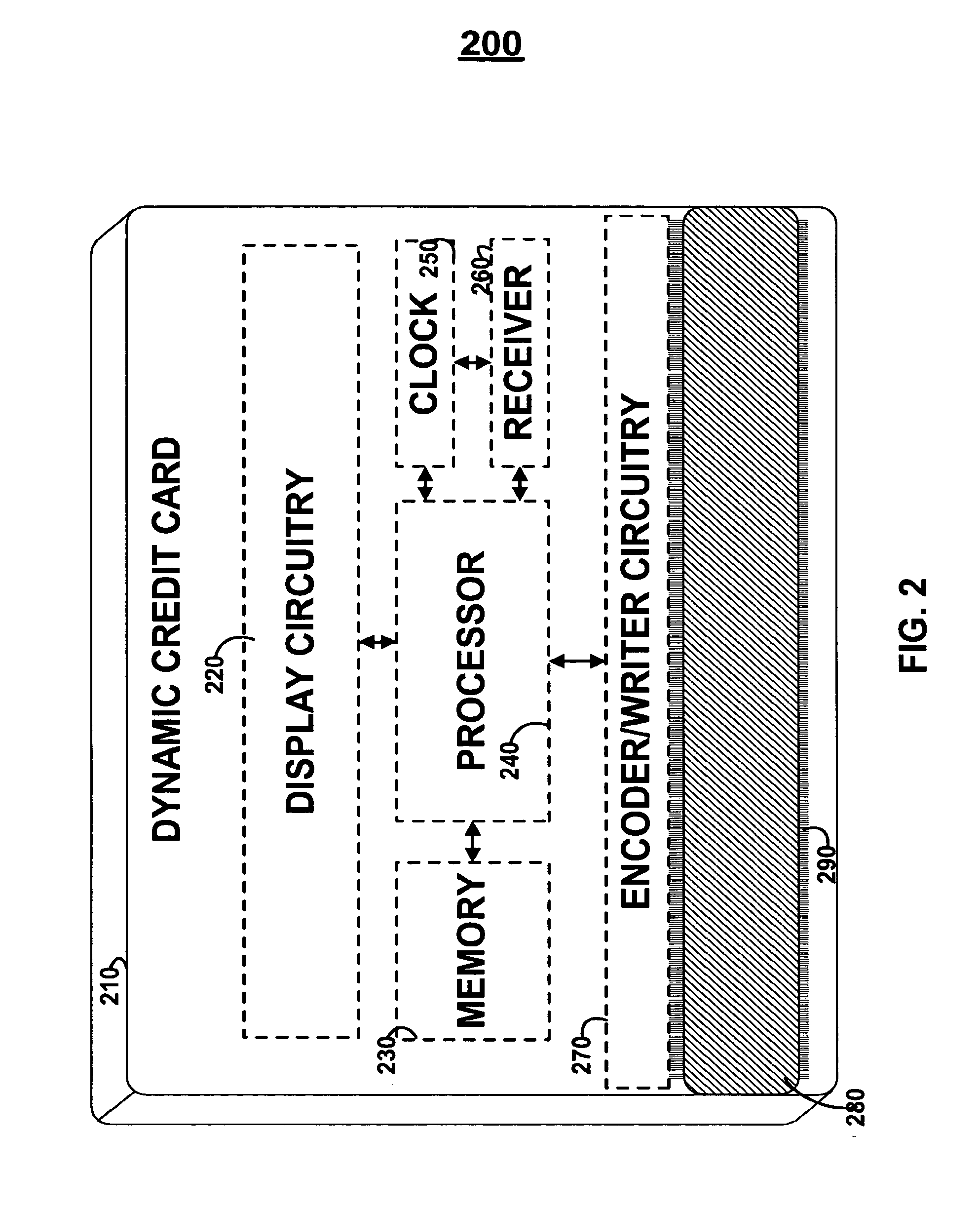

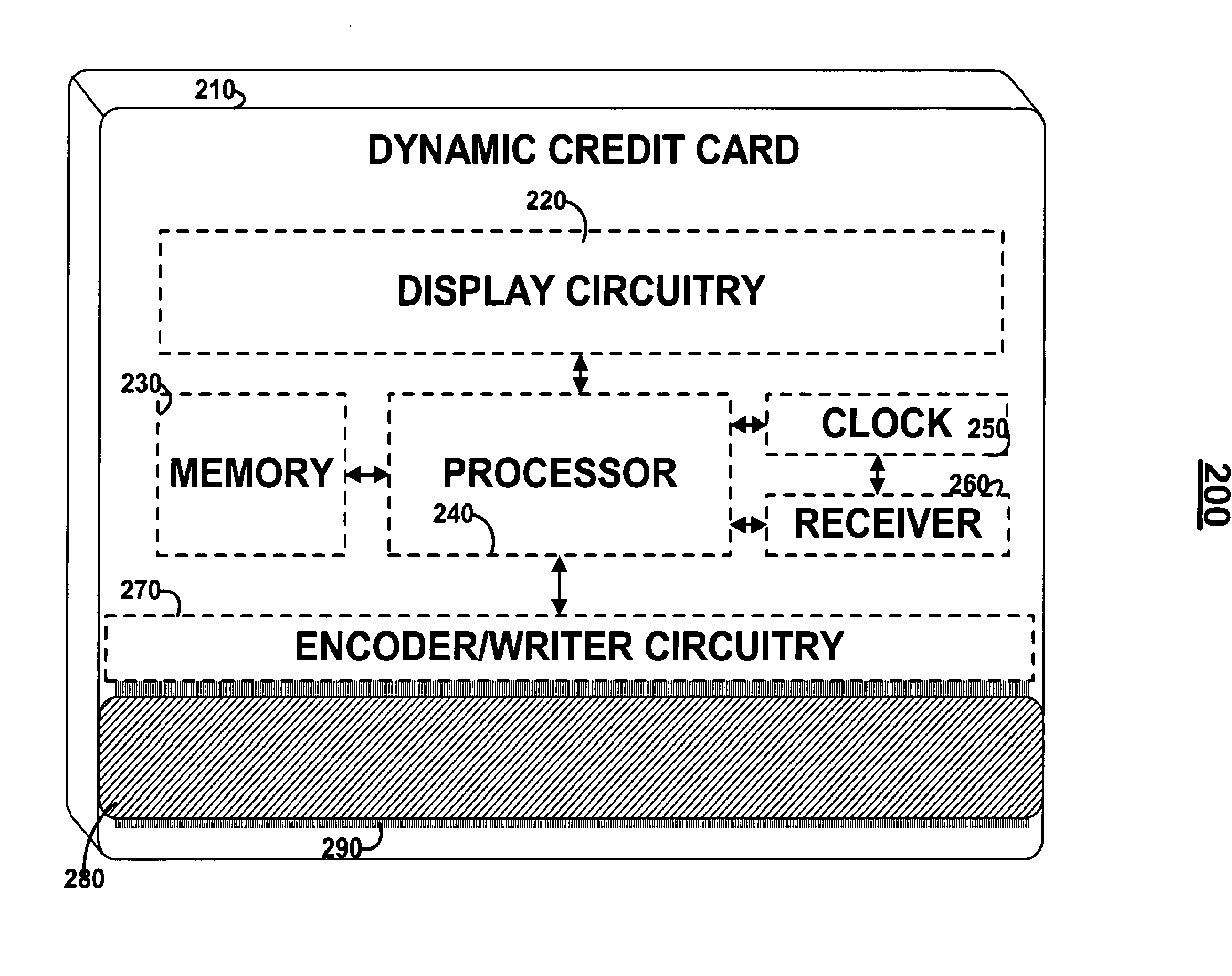

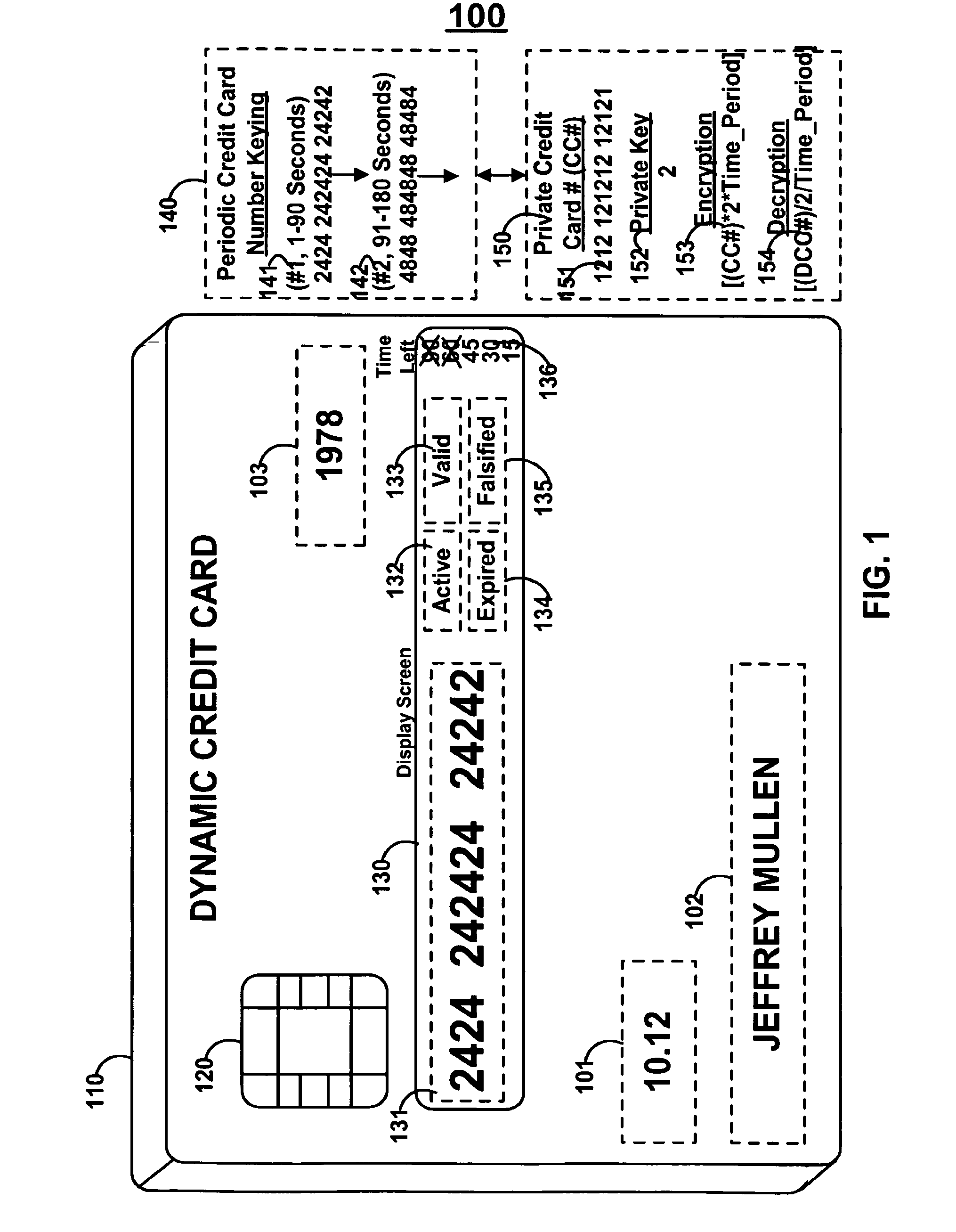

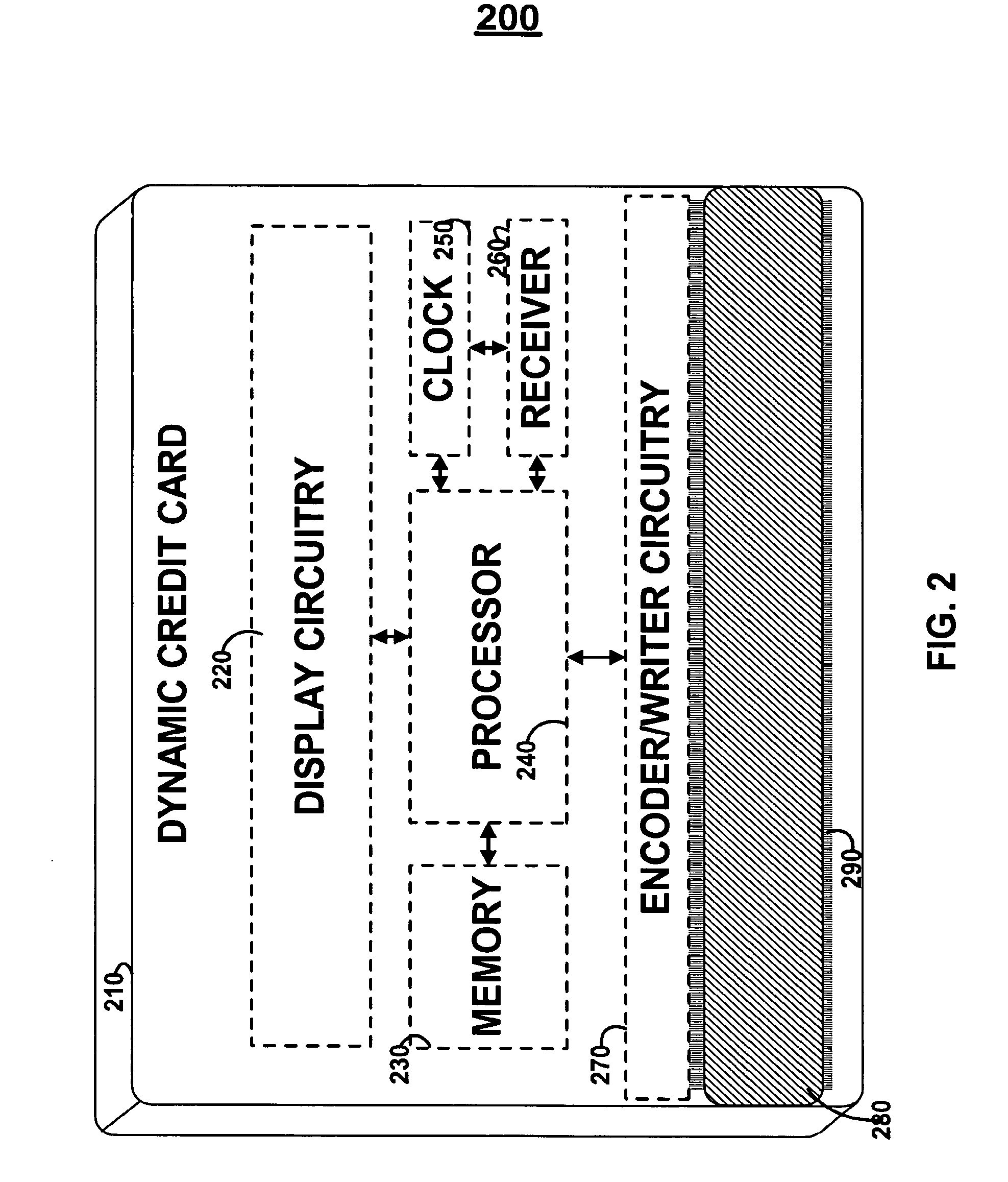

Dynamic credit card with magnetic stripe and embedded encoder and methods for using the same to provide a copy-proof credit card

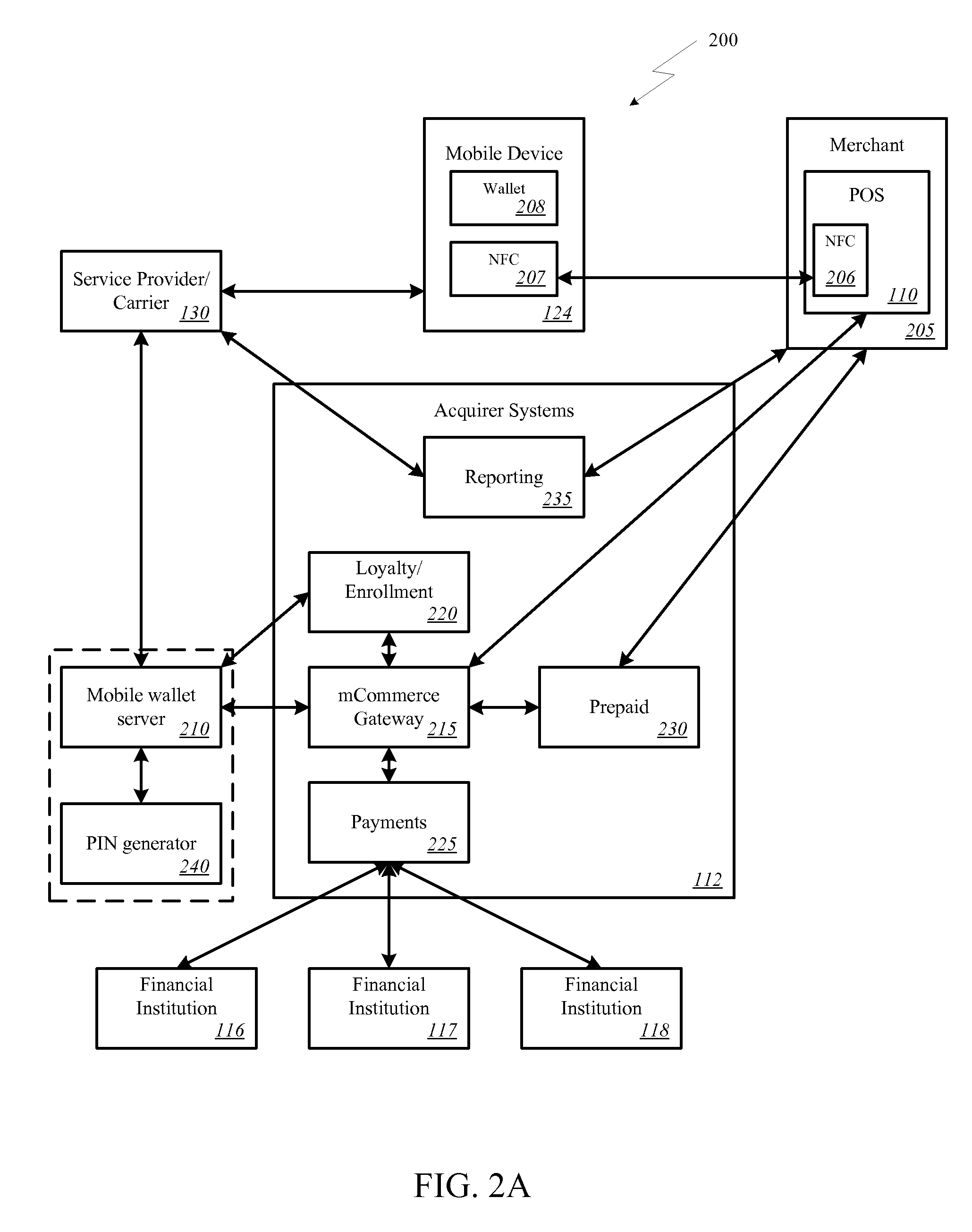

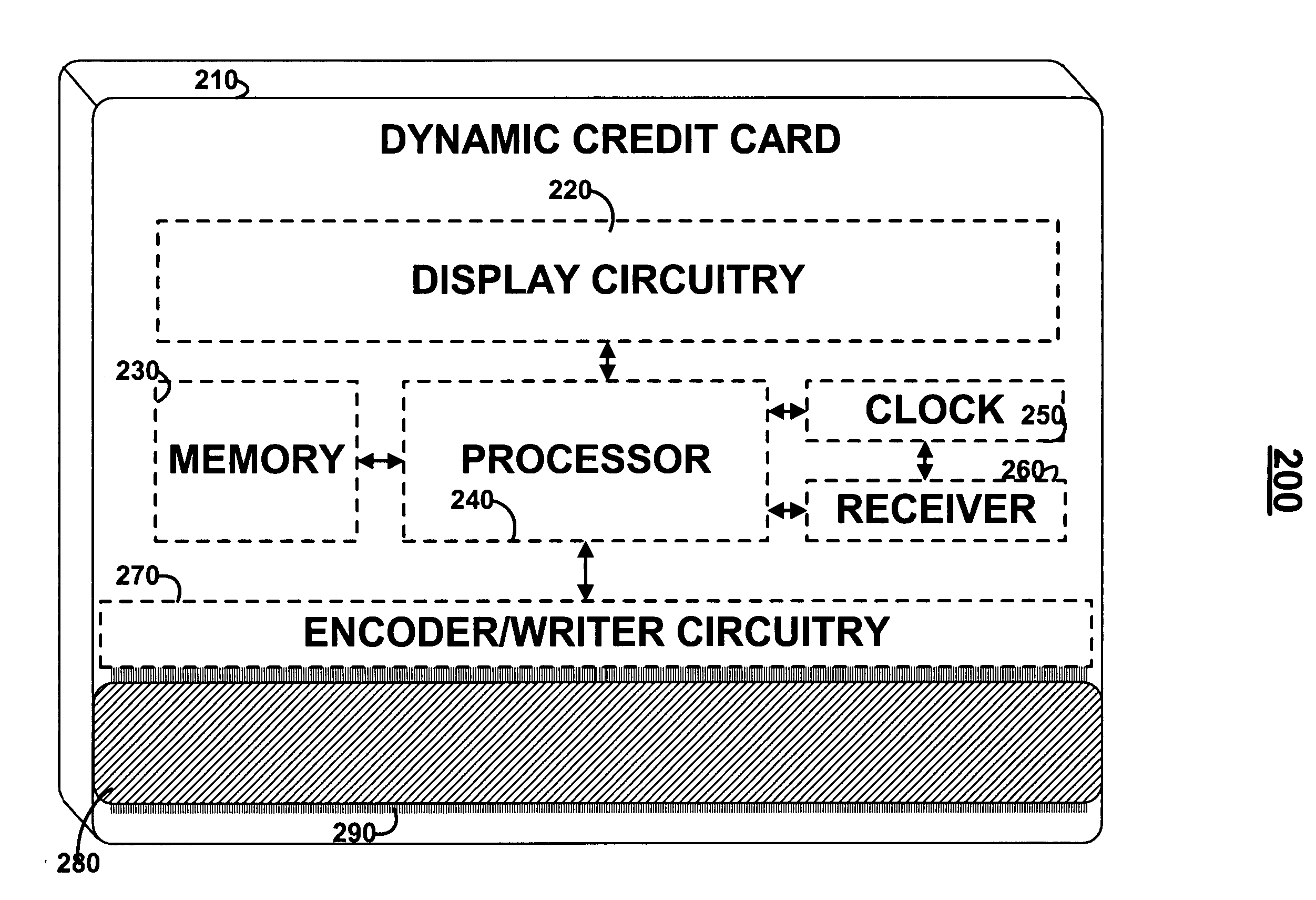

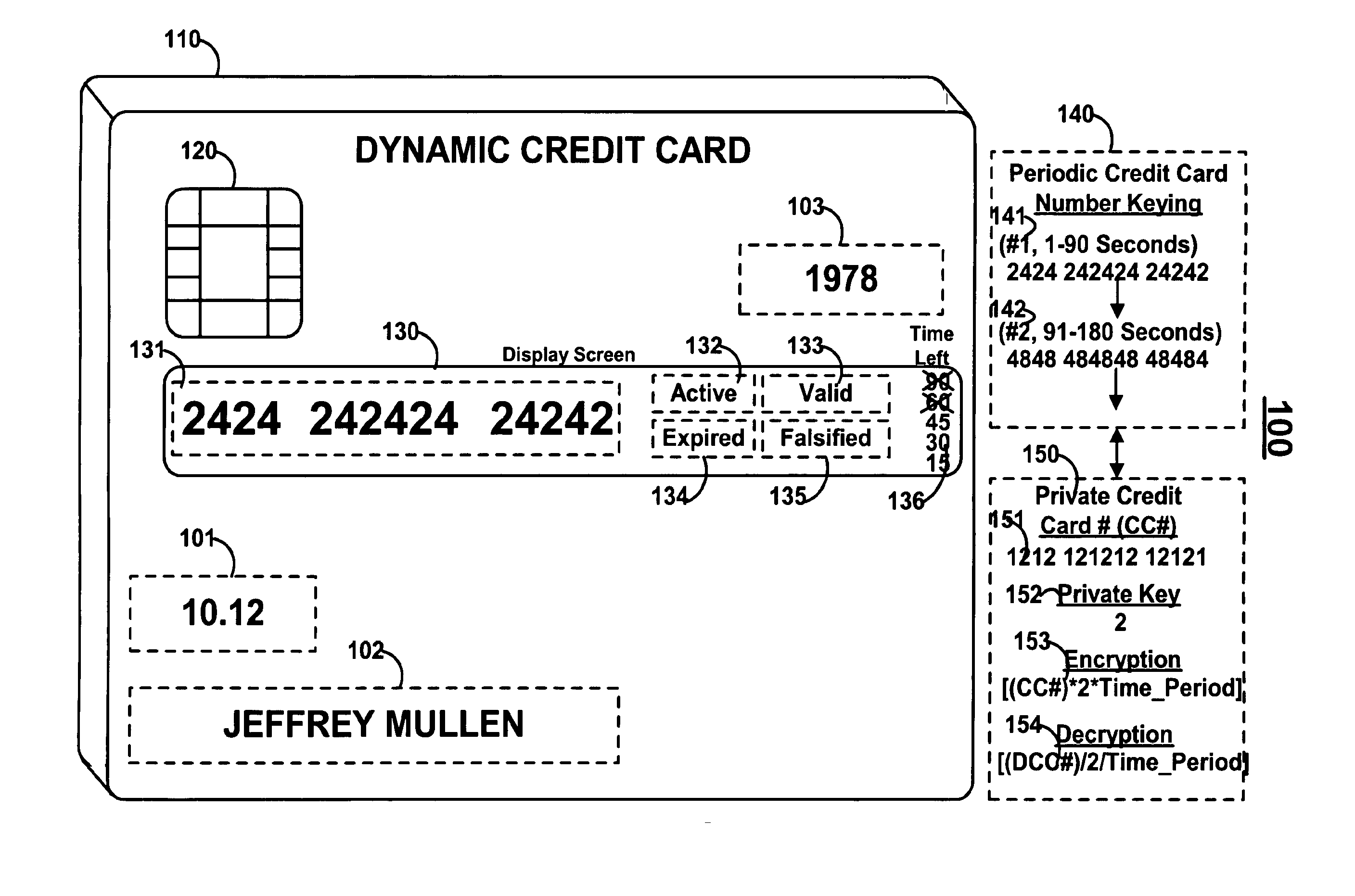

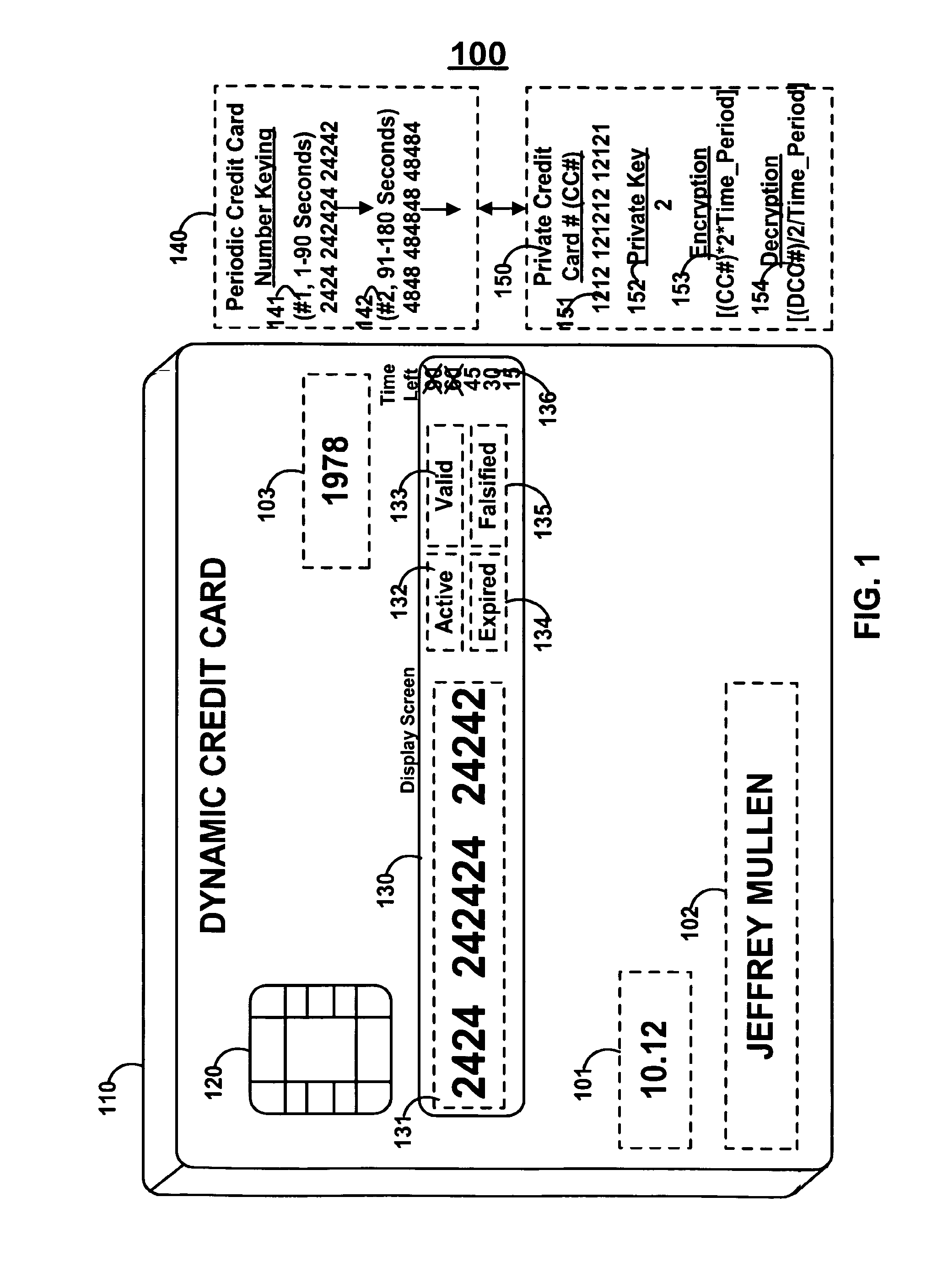

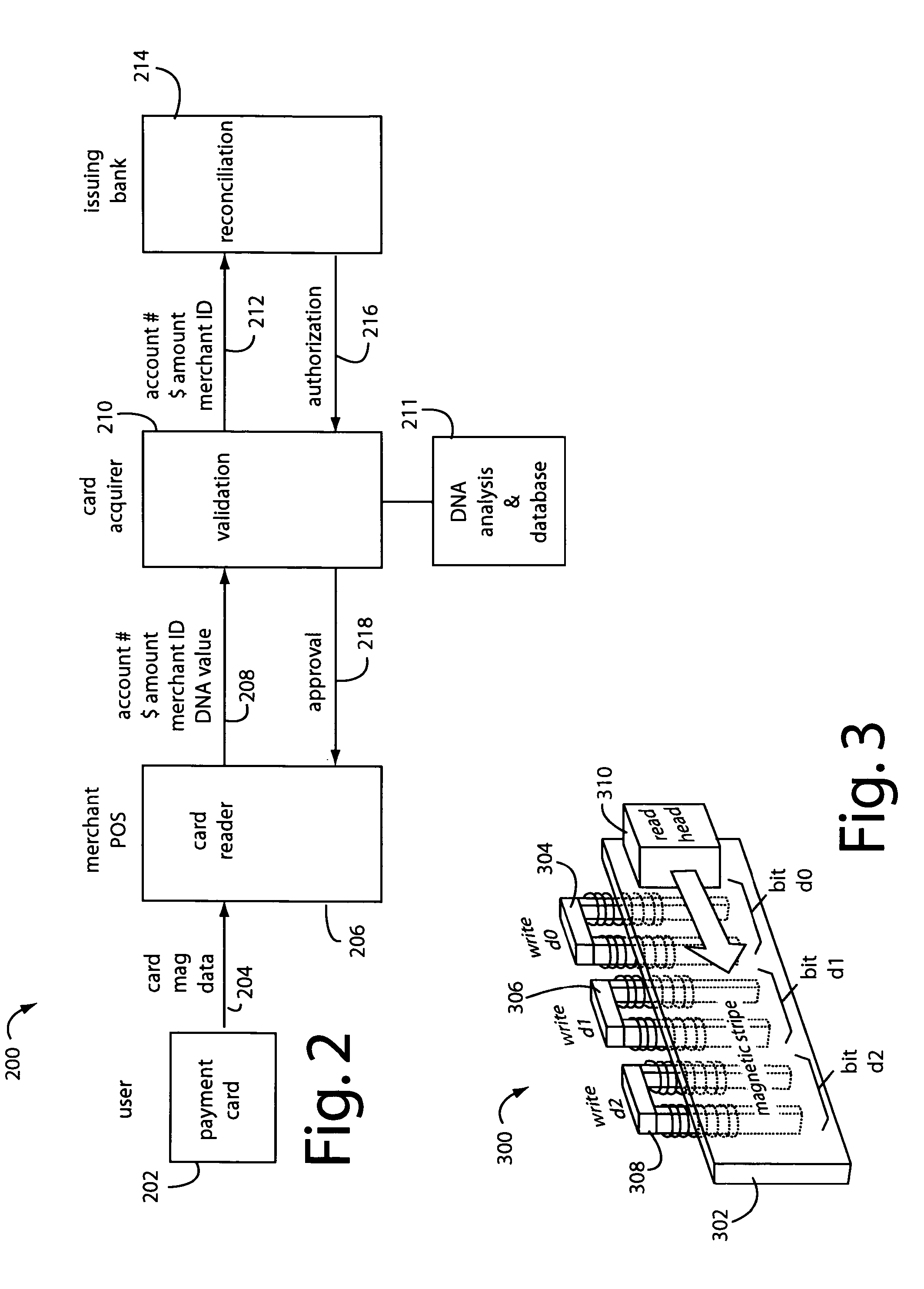

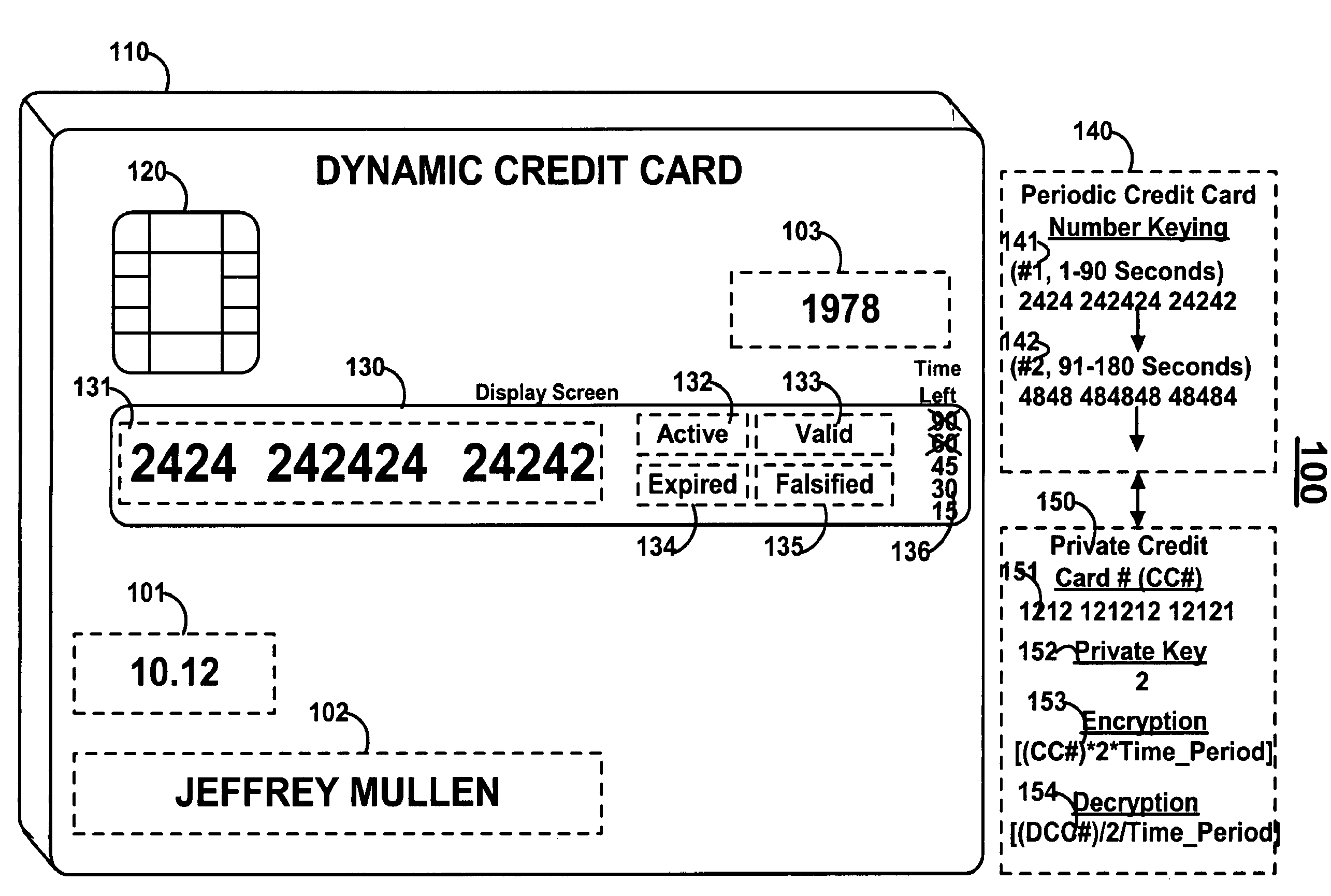

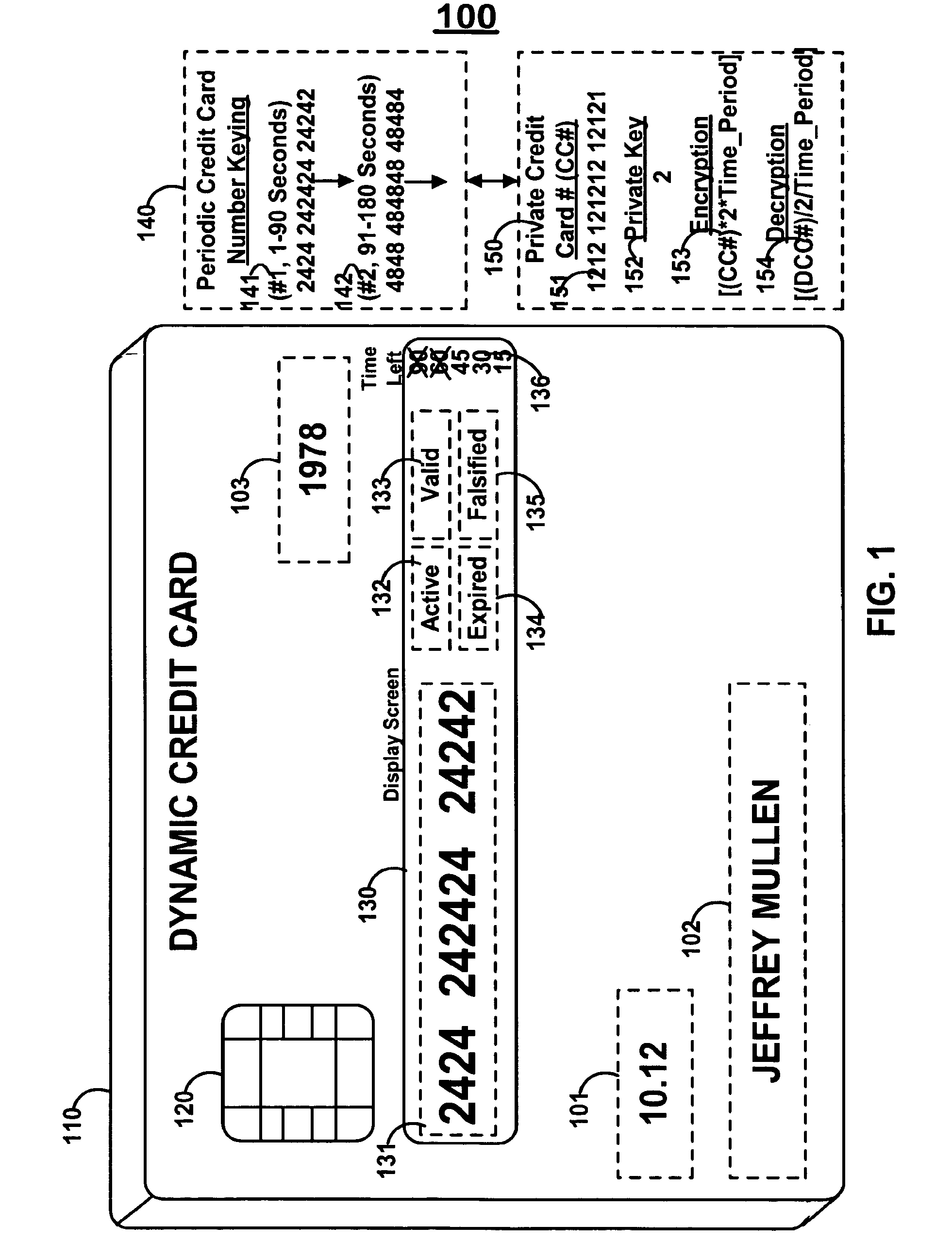

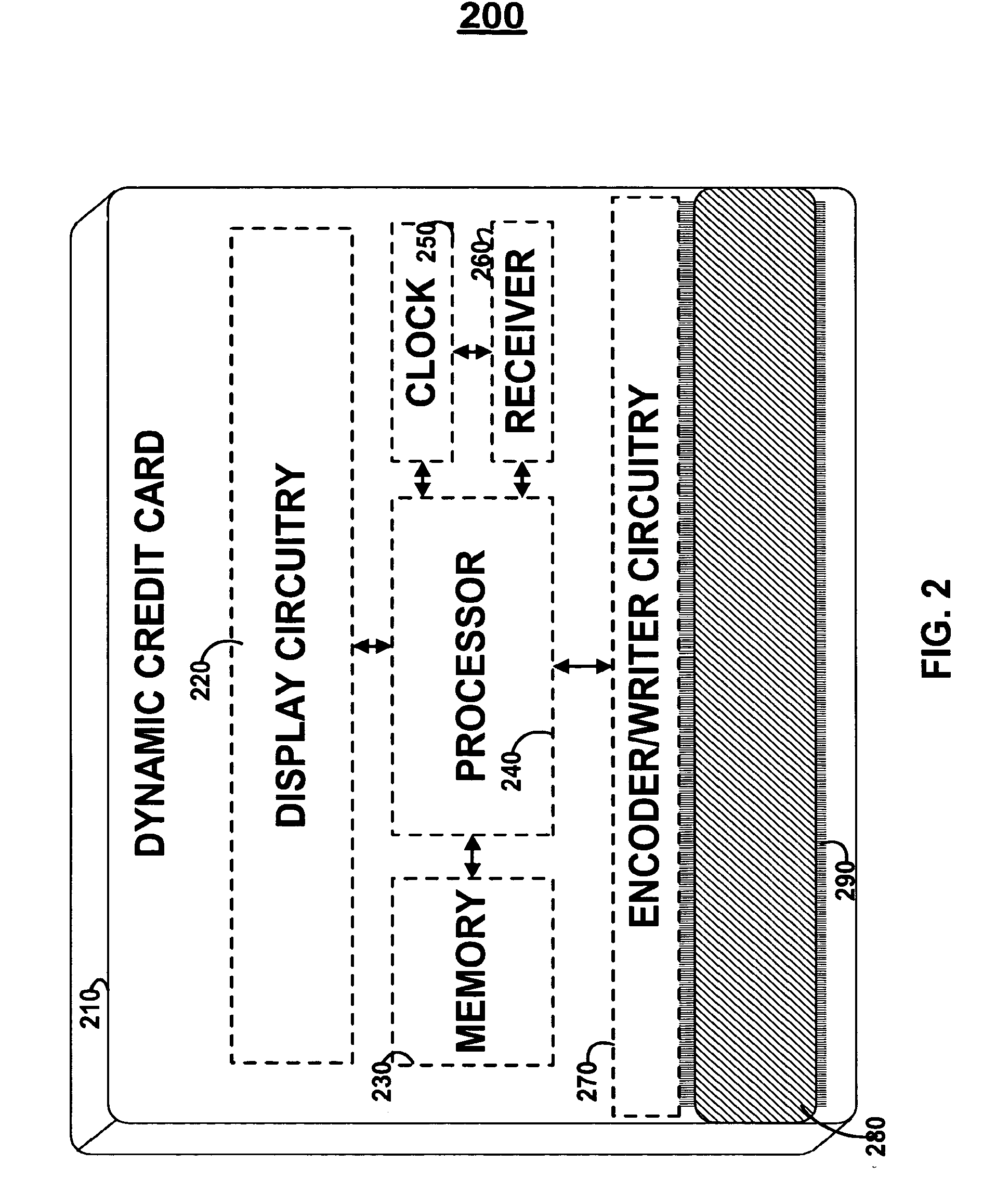

A dynamic credit card is provided in which a secure credit card number (e.g., a secret / hidden credit card number) is encoded based on a timing signal (e.g., an internal counter) to provide a dynamic credit card number. This dynamic number may be displayed to a user via a display (e.g., so that online purchases can be made) or written onto a magnetic stripe such that the number may be processed by traditional credit card merchants (e.g., swiped). At a remote facility, the dynamic number may be decoded based on time (and / or a counter / key number / equation) or the facility may have the secure number and perform the same function as the dynamic credit card (e.g., encode using time data as a parameter to the encoding equation) and compare the resultant dynamic number to the dynamic number received. Thus, a dynamic credit card number may change continually or periodically (e.g., every sixty seconds) such that credit card numbers may not be copied by thieves and used at later times. A dynamic verification code may be utilized in addition to, or in lieu of, a dynamic credit card number.

Owner:DYNAMICS

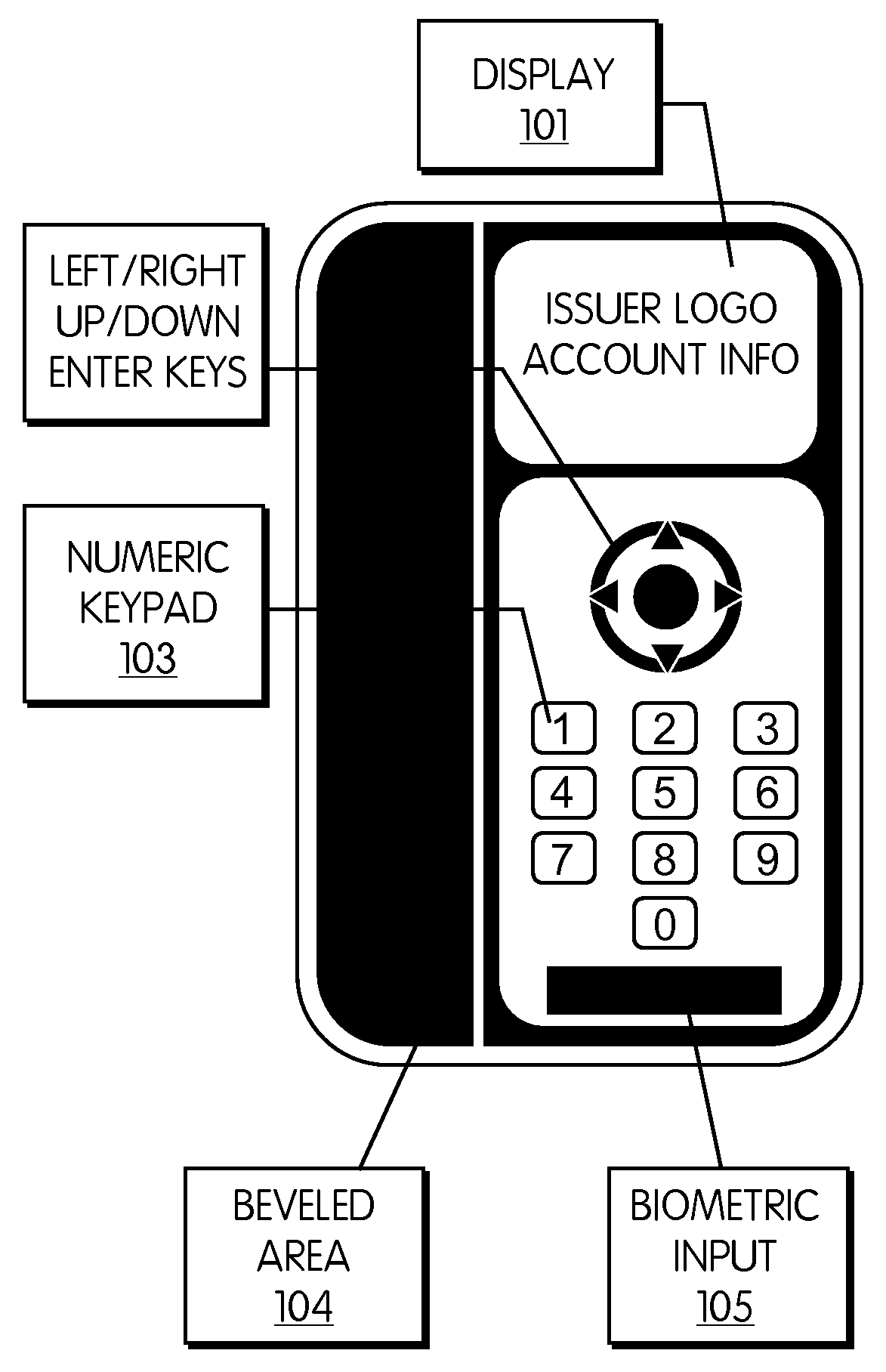

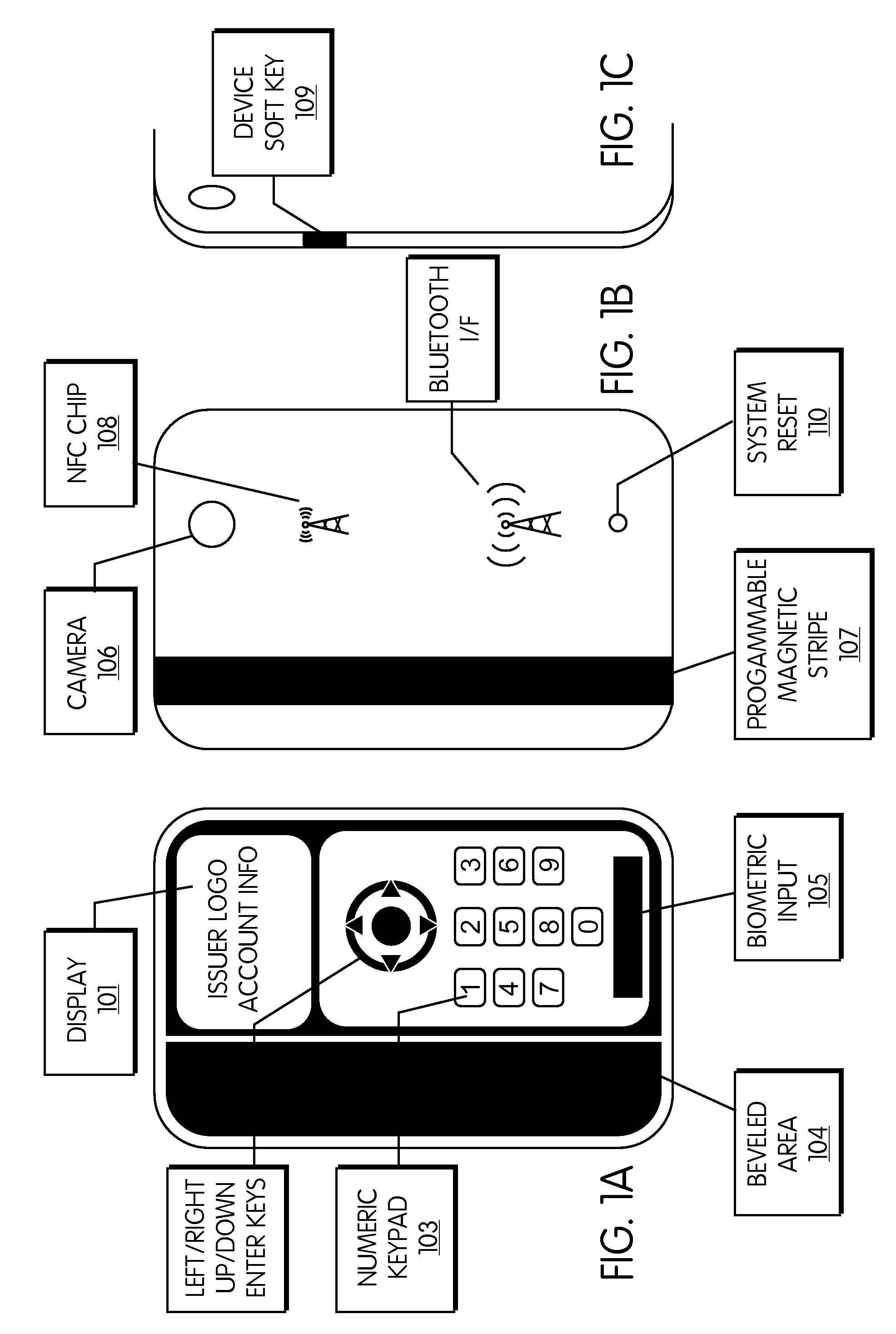

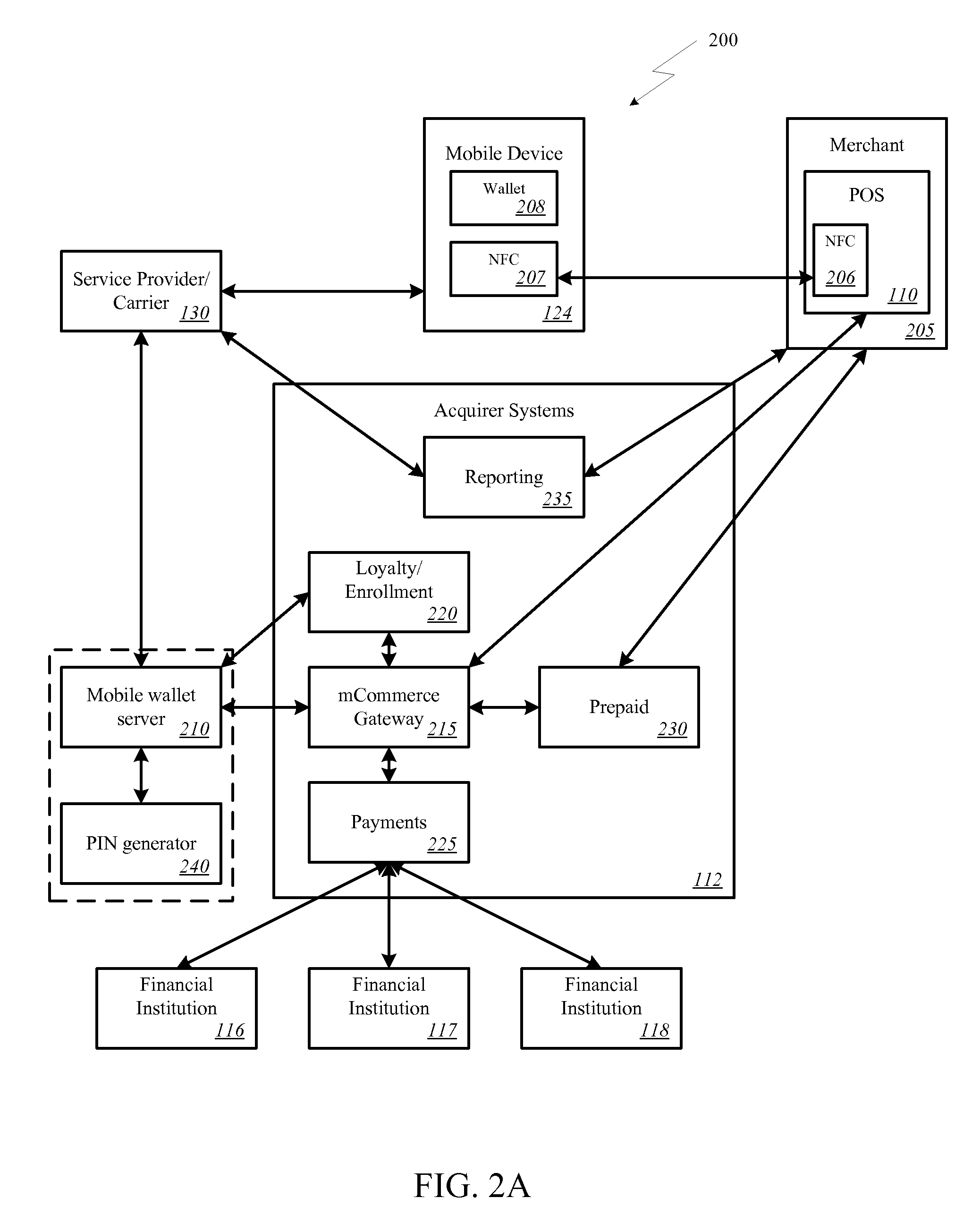

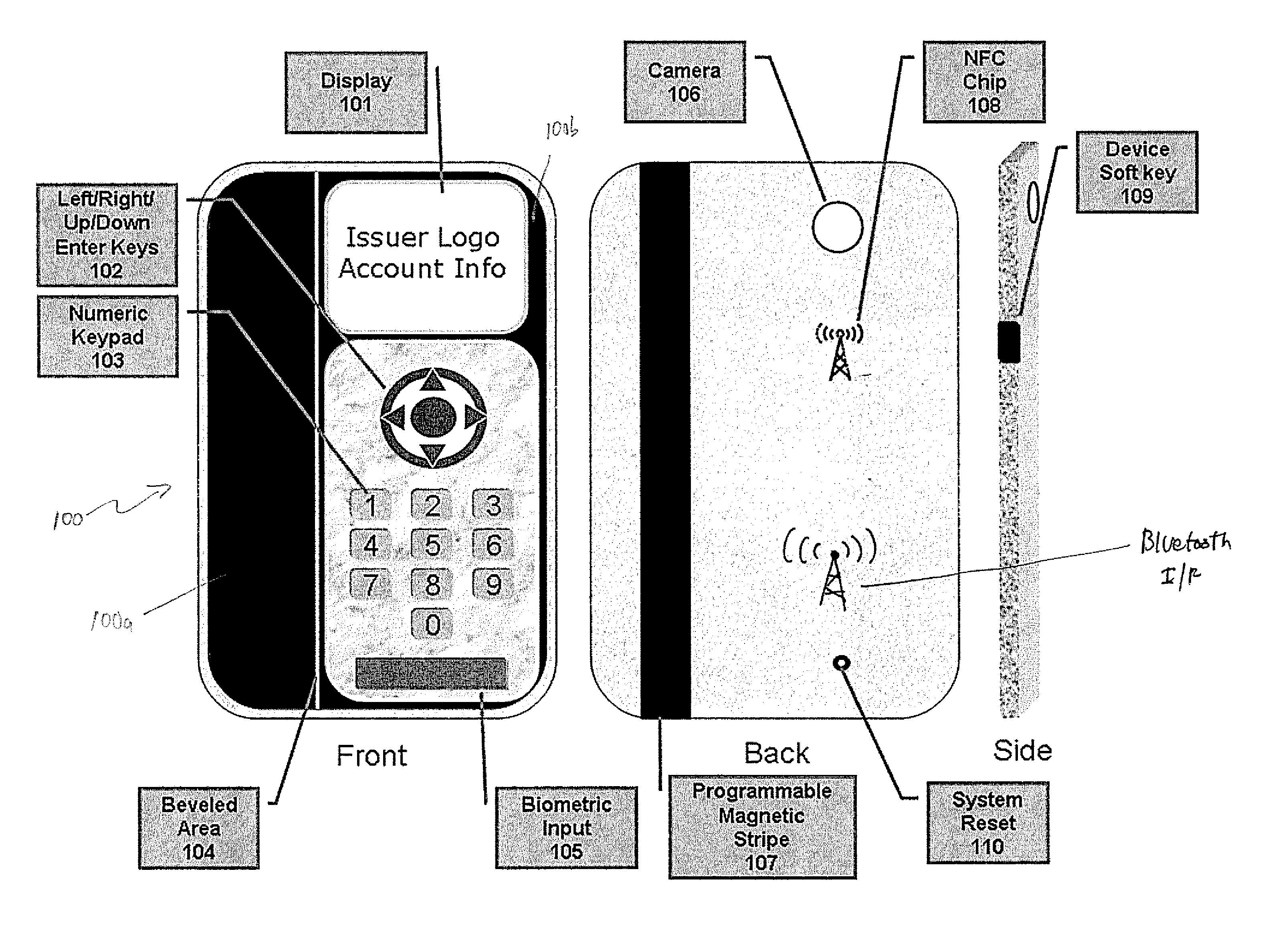

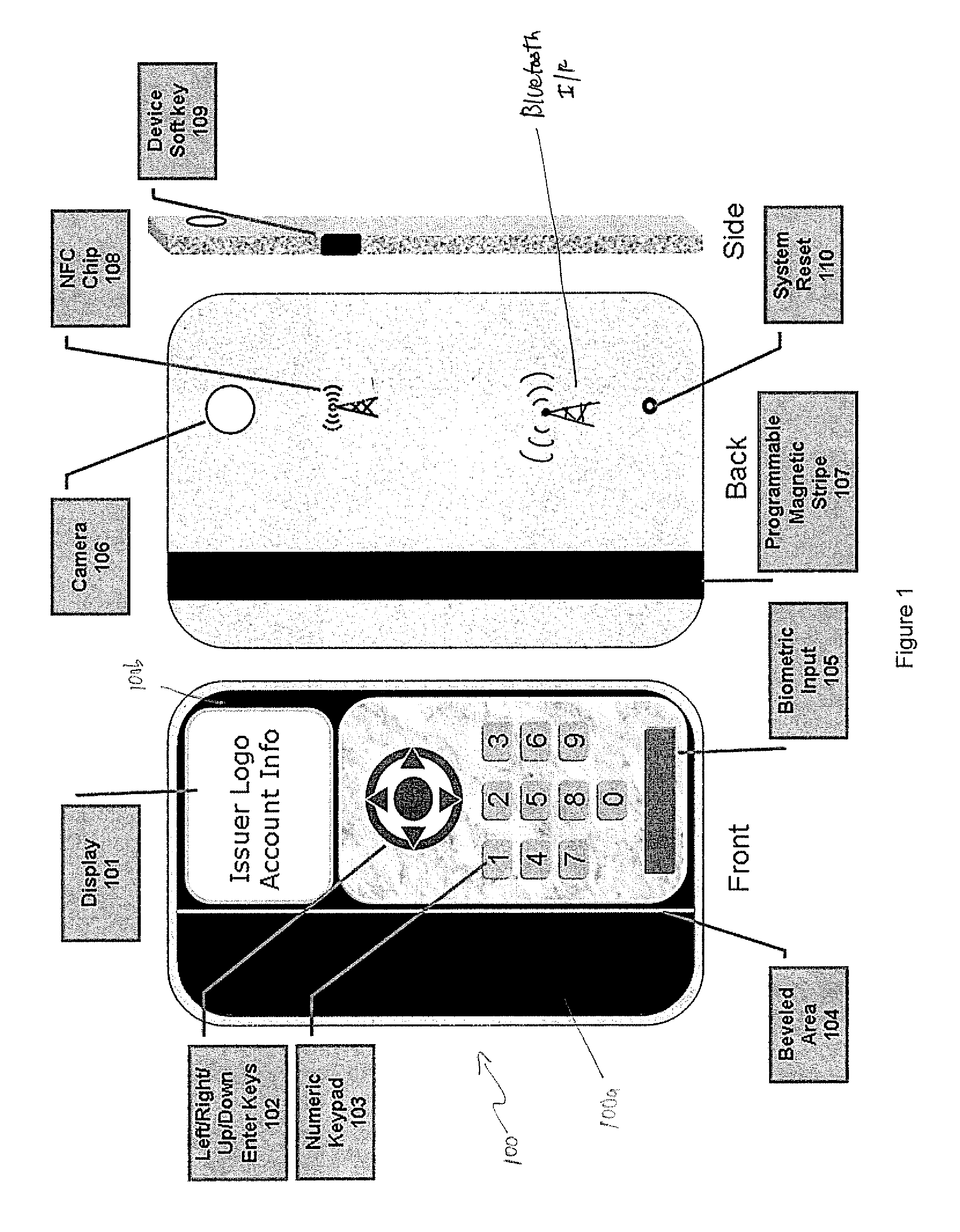

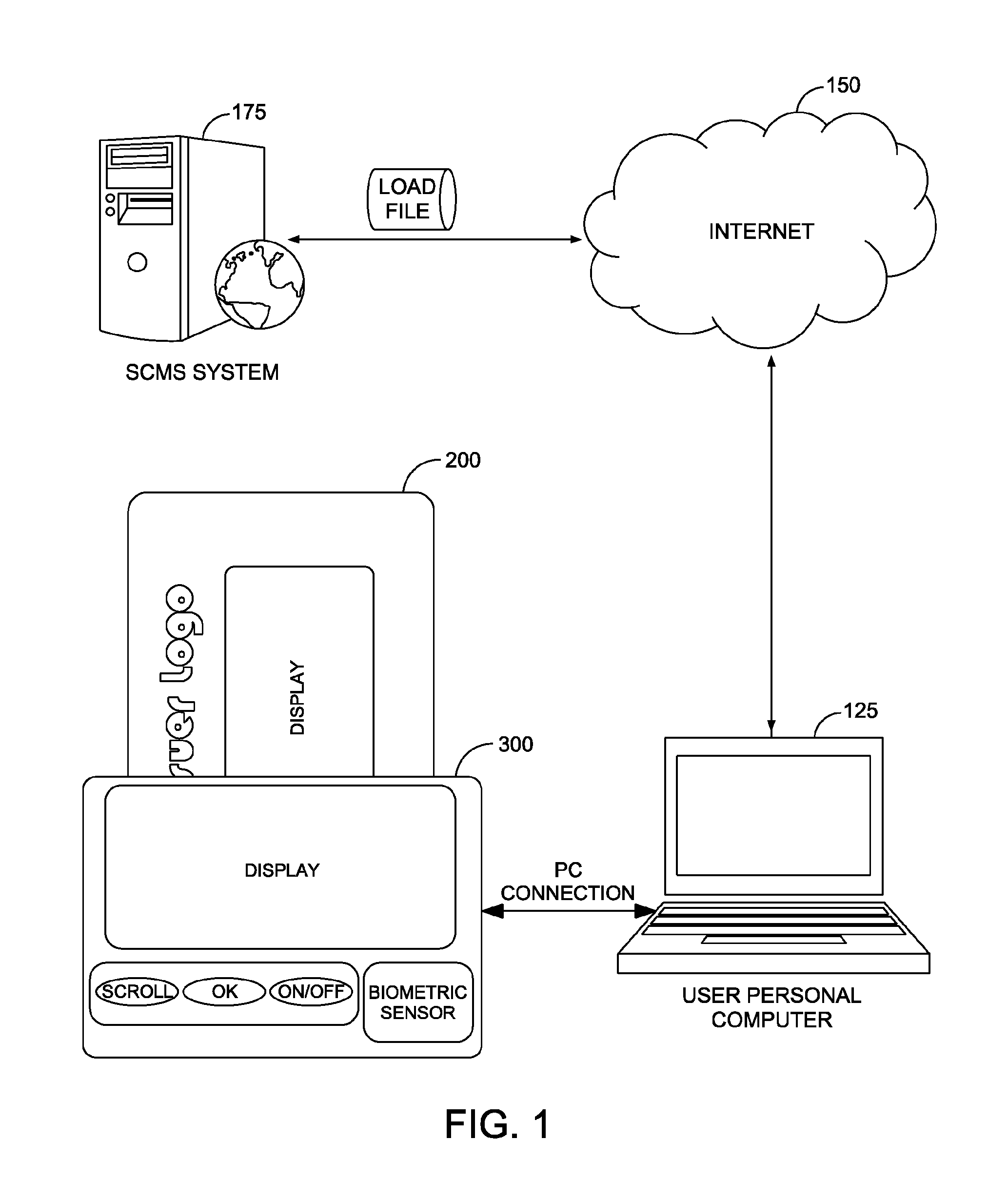

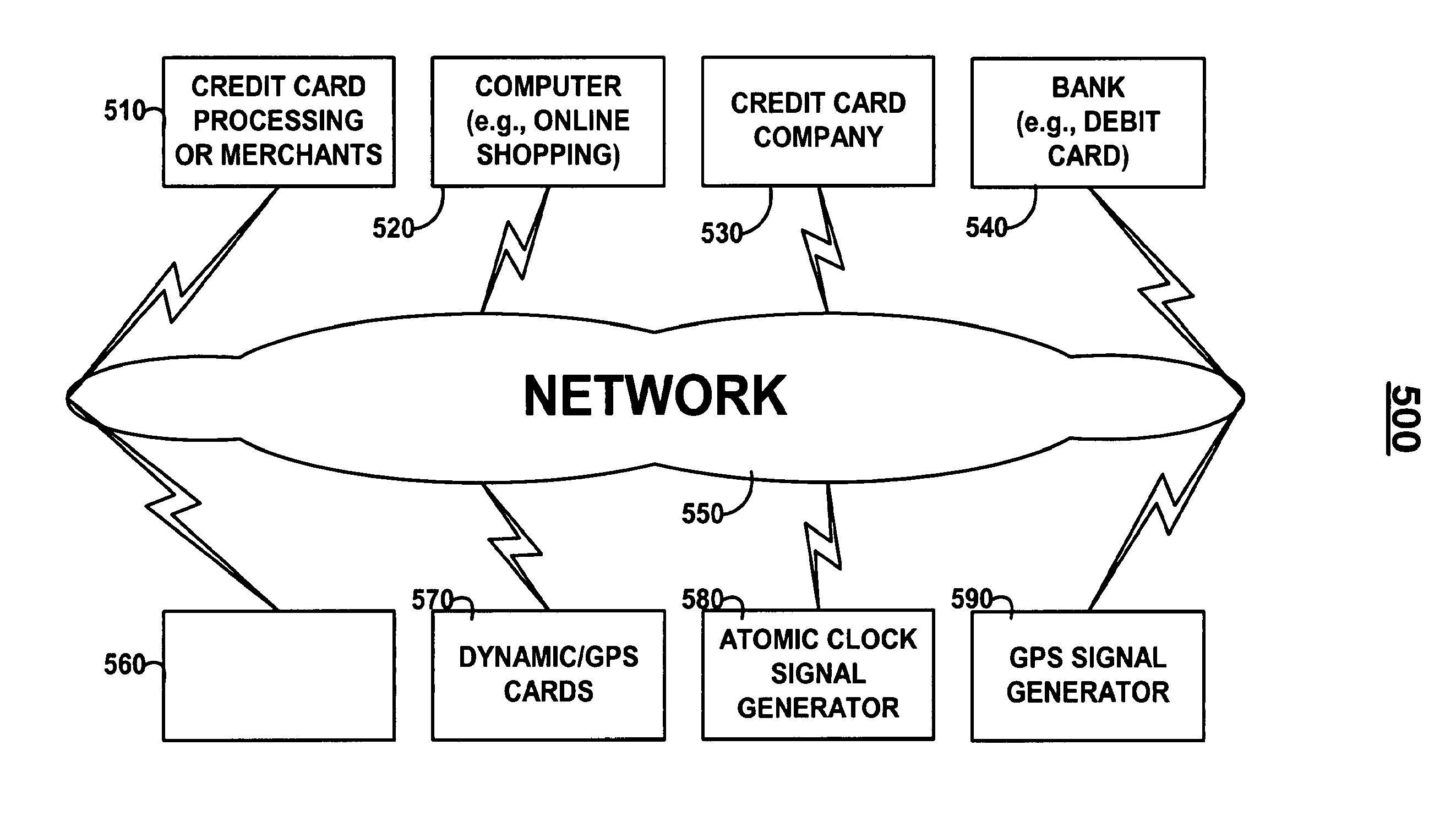

Point Of Sale Transaction Device With Magnetic Stripe Emulator And Biometric Authentication

InactiveUS20080126260A1Cost effectiveImprove security levelAcutation objectsPoint-of-sale network systemsData setComputer science

A handheld unit which is capable of emulating a plurality of smartcards or magnetic stripe cards. The unit has the capability of storing a plurality of data sets representing a plurality of accounts. The unit is equipped with an RF interface that can emulate a smartcard interface that is capable of communicating with smartcard readers at POS or ATM terminals, or anywhere else a smartcard may be utilized. The unit is also equipped with a programmable magnetic strip such that it can be used anywhere a magnetic stripe card can be swiped or inserted. The unit is equipped with a biometric sensor to positively verify an authenticated user.

Owner:X CARD HLDG

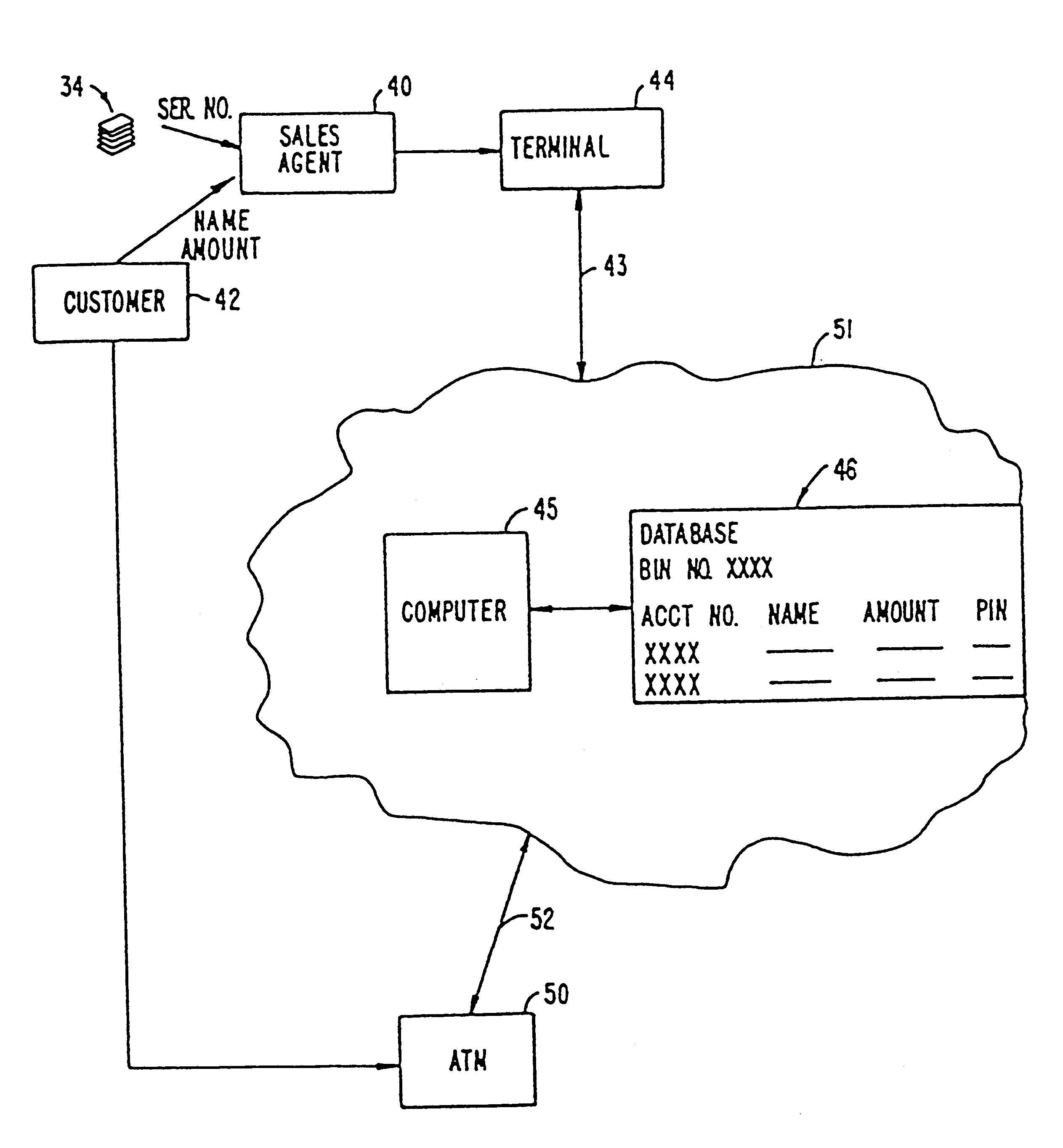

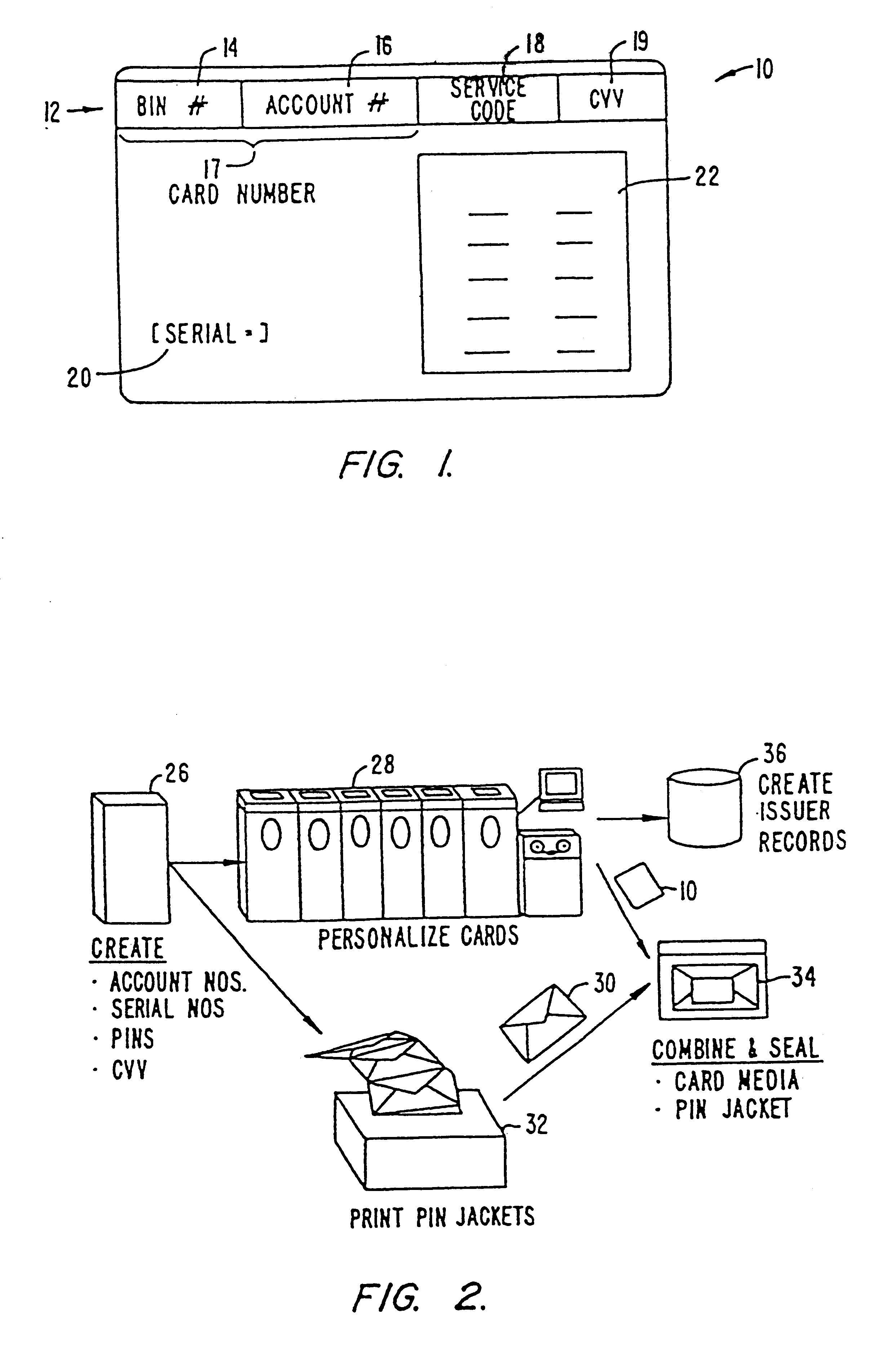

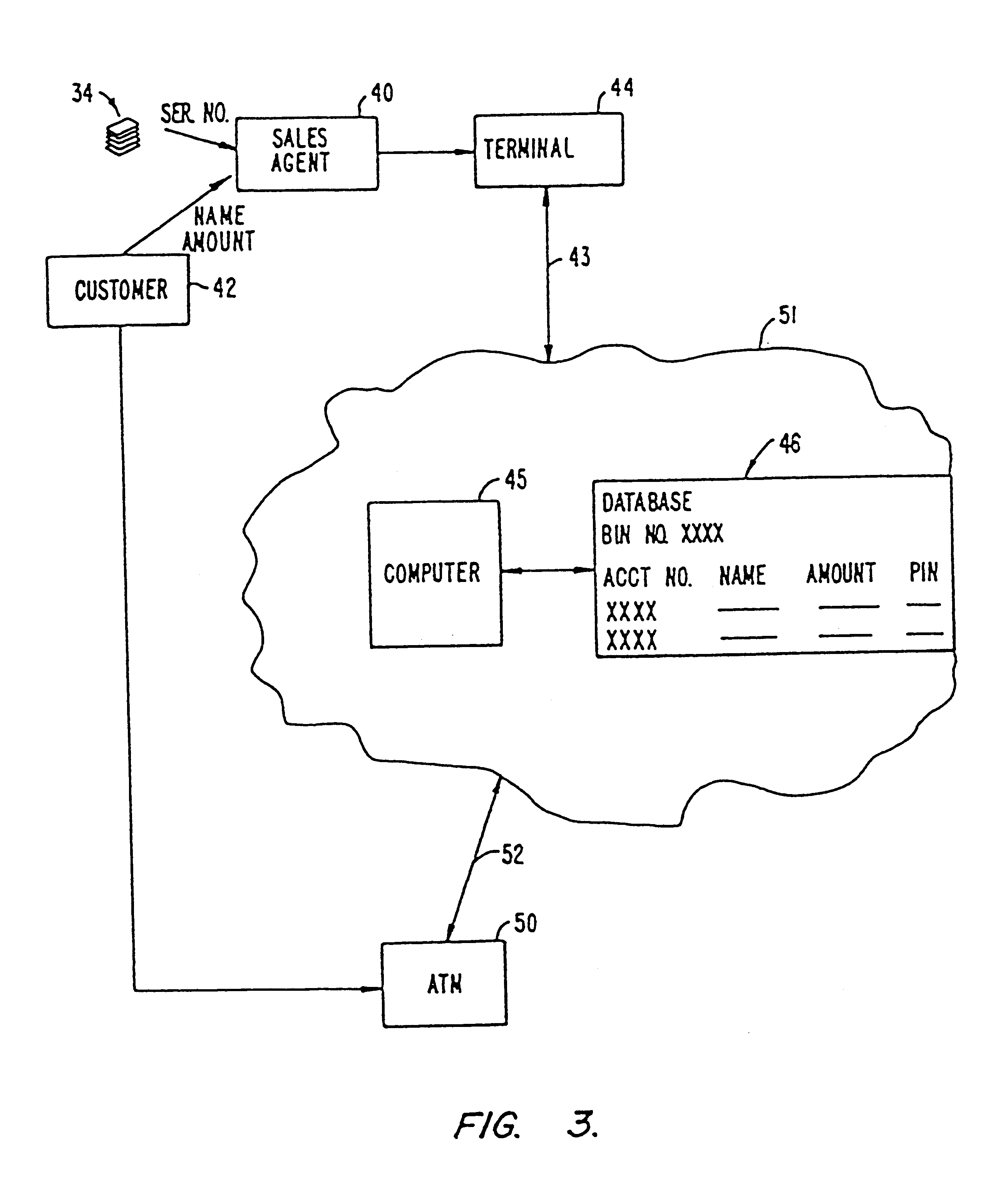

Method and apparatus for distributing currency

InactiveUSRE37122E1Improve securityComplete banking machinesCredit registering devices actuationElectronic accessComputer terminal

A process which provides electronic access to pre-paid funds for cash or payment for goods and services. A card is issued to a customer with a value selectable by the customer. The card has a magnetic stripe with an encoded card number including a bank identification number (BIN) and an account number. The central card processor establishes a zero balance database including the card numbers, but with blank fields for the customer data and the value of the account. When a customer purchases a card, the sales agent transmits to the central database computer which fills in the blanks in the database, activating the account, and transmits an acknowledgement signal back to the sales agent. The customer can immediately use the card in ATM or other remote terminals to acquire cash or purchase goods and services. The customer inputs a PIN number which is provided with the card, or a customer selected alternative PIN number.

Owner:VISA INT SERVICE ASSOC

Onetime passwords for smart chip cards

ActiveUS20090200371A1Unauthorised/fraudulent call preventionEavesdropping prevention circuitsDisplay deviceFinancial transaction

A financial transaction card is provided according to various embodiments described herein. The financial transaction card includes a card body with at least a front surface and a back surface. The financial transaction card may also include a near field communications transponder and / or a magnetic stripe, as well as a digital display configured to display alphanumeric characters on the front surface of the card body. The financial transaction card may also include a processor that is communicatively coupled with the near field communications transponder or magnetic stripe and the digital display. The processor may be configured to calculate one-time passwords and communicate the one-time passwords to both the near filed communications transponder or magnetic stripe and the digital display.

Owner:FIRST DATA

Smartcard and magnetic stripe emulator with biometric authentication

Owner:X CARD HLDG

Dynamic credit card with magnetic stripe and embedded encoder and methods for using the same to provide a copy-proof credit card

A dynamic credit card is provided in which a secure credit card number (e.g., a secret / hidden credit card number) is encoded based on a timing signal (e.g., an internal counter) to provide a dynamic credit card number. This dynamic number may be displayed to a user via a display (e.g., so that online purchases can be made) or written onto a magnetic stripe such that the number may be processed by traditional credit card merchants (e.g., swiped). At a remote facility, the dynamic number may be decoded based on time (and / or a counter / key number / equation) or the facility may have the secure number and perform the same function as the dynamic credit card (e.g., encode using time data as a parameter to the encoding equation) and compare the resultant dynamic number to the dynamic number received. Thus, a dynamic credit card number may change continually or periodically (e.g., every sixty seconds) such that credit card numbers may not be copied by thieves and used at later times. A dynamic verification code may be utilized in addition to, or in lieu of, a dynamic credit card number.

Owner:DYNAMICS

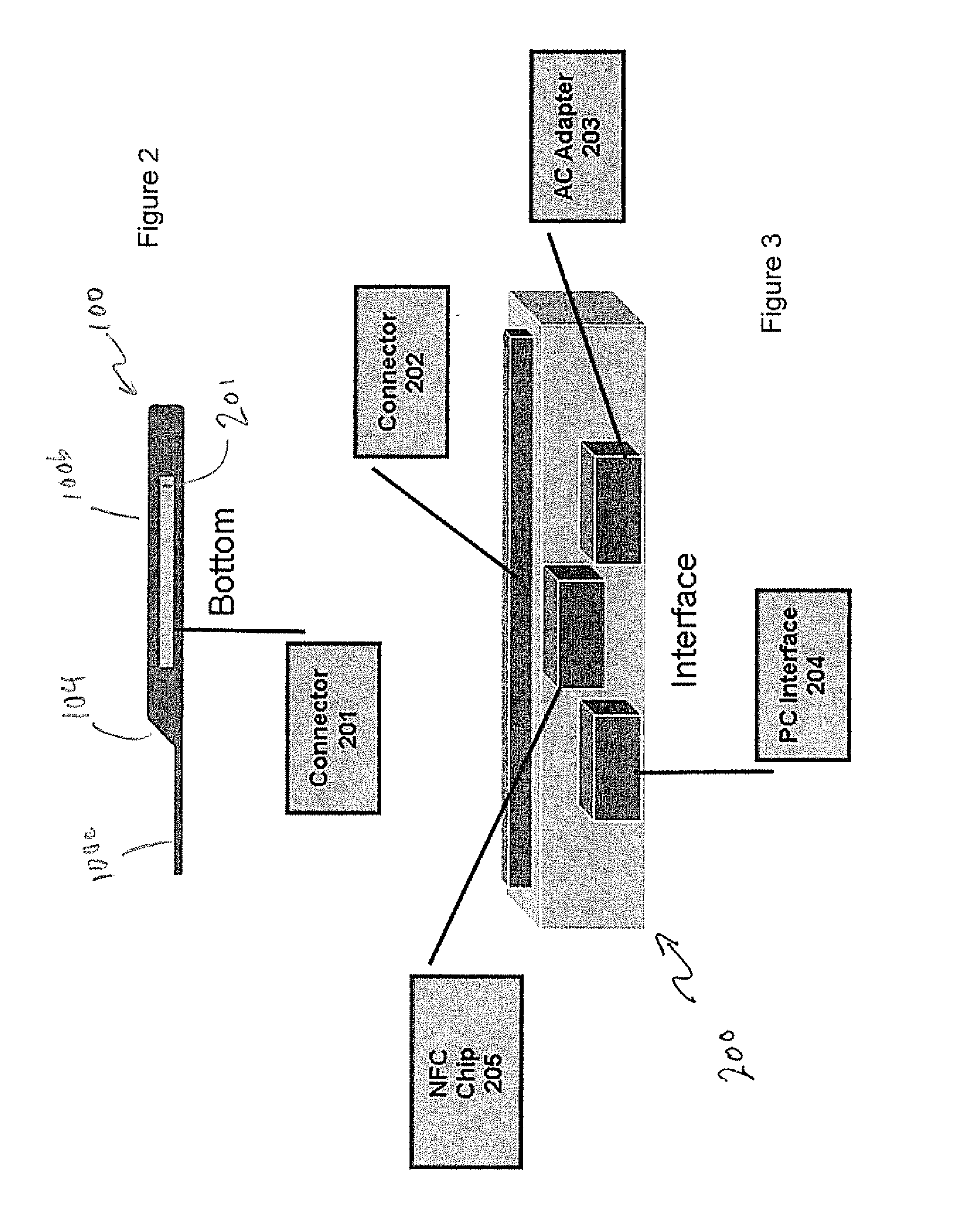

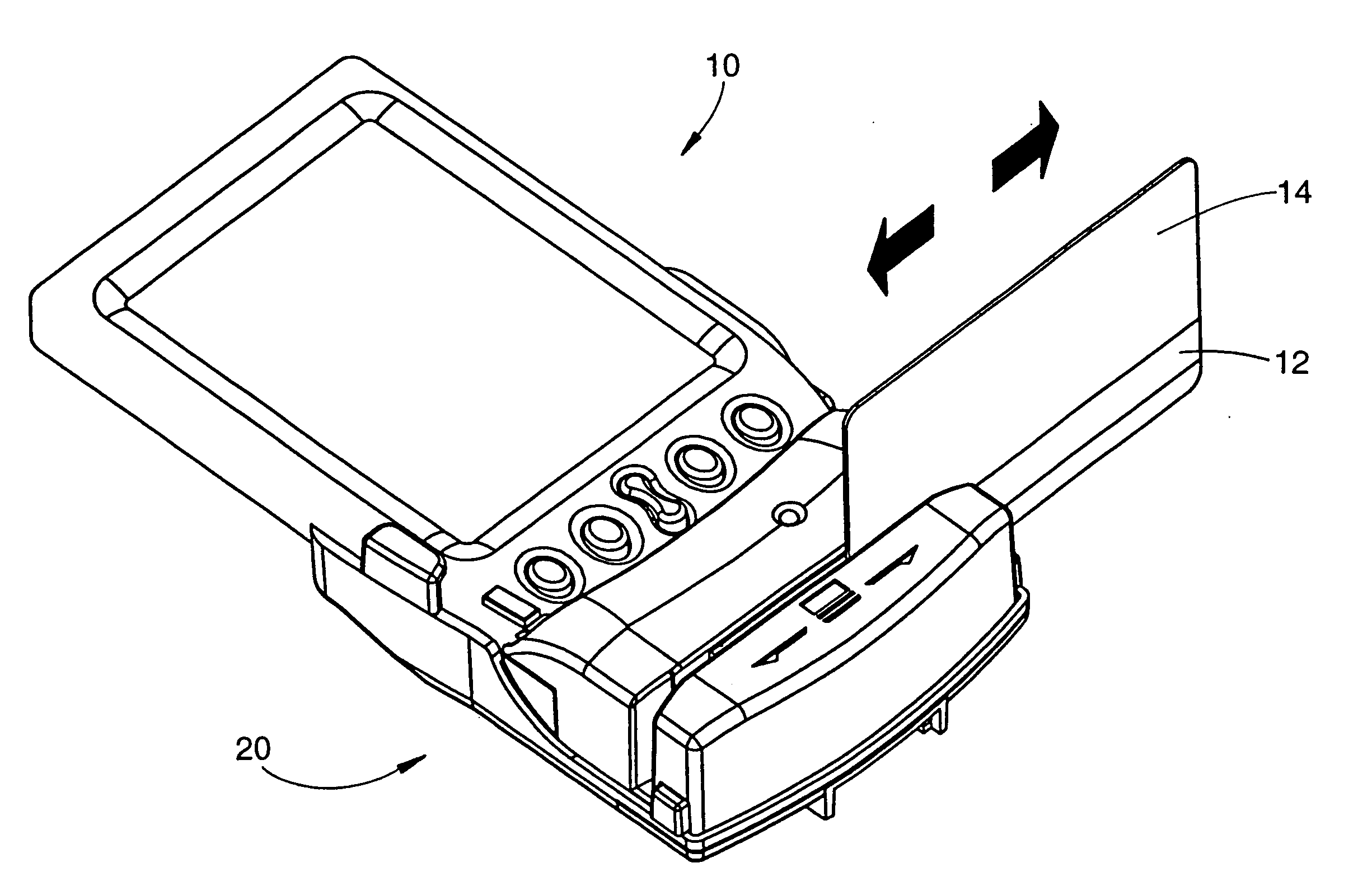

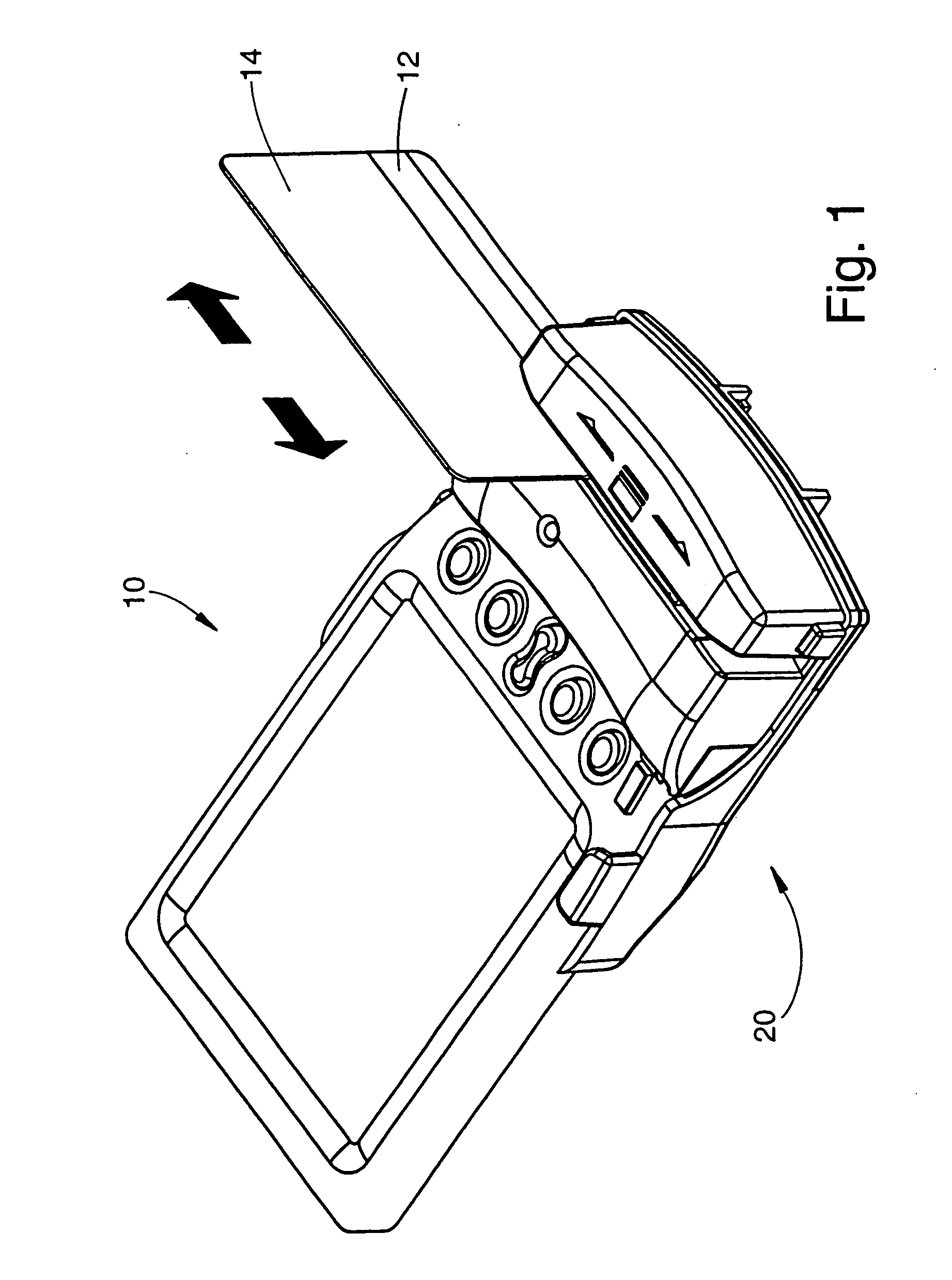

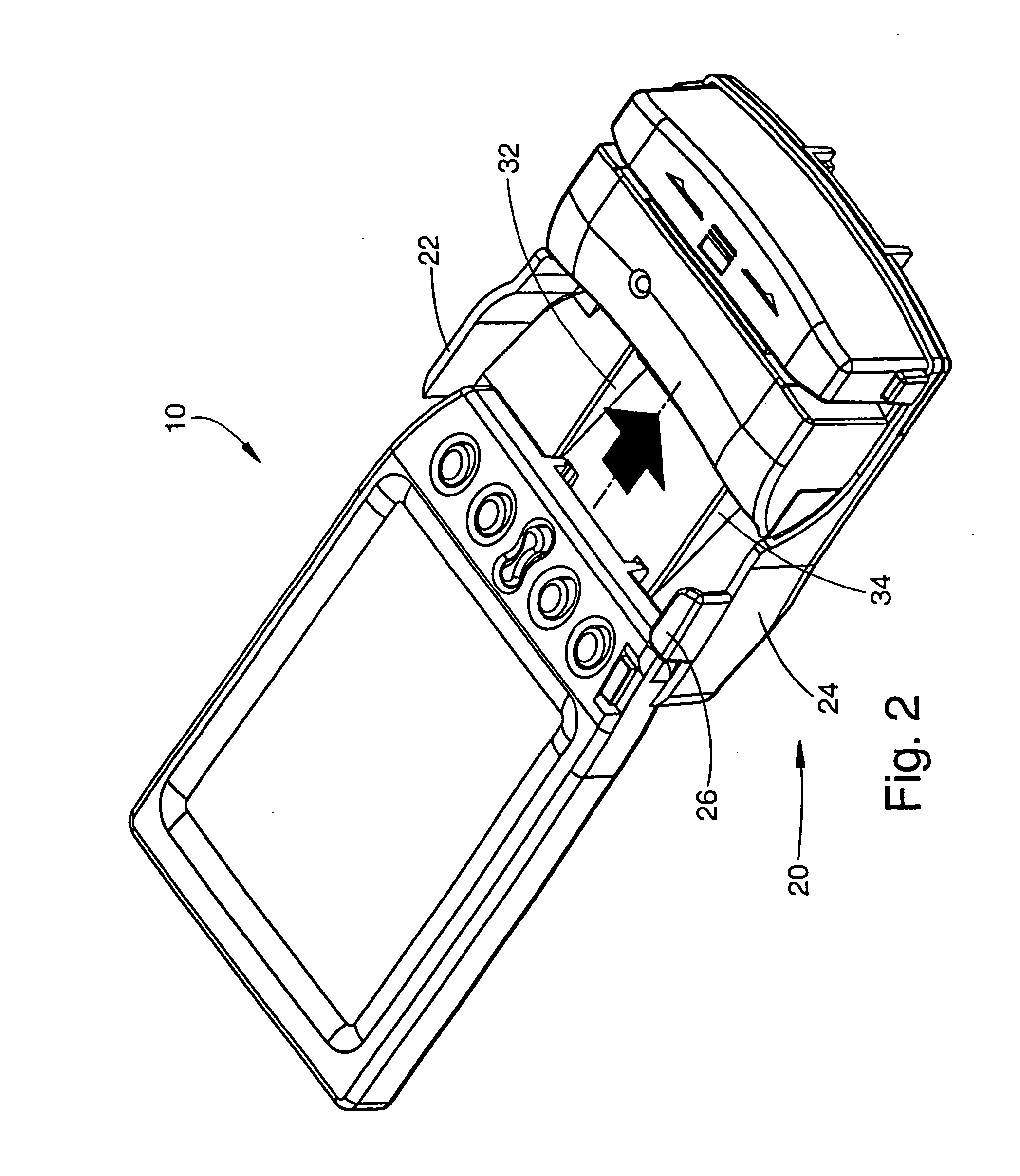

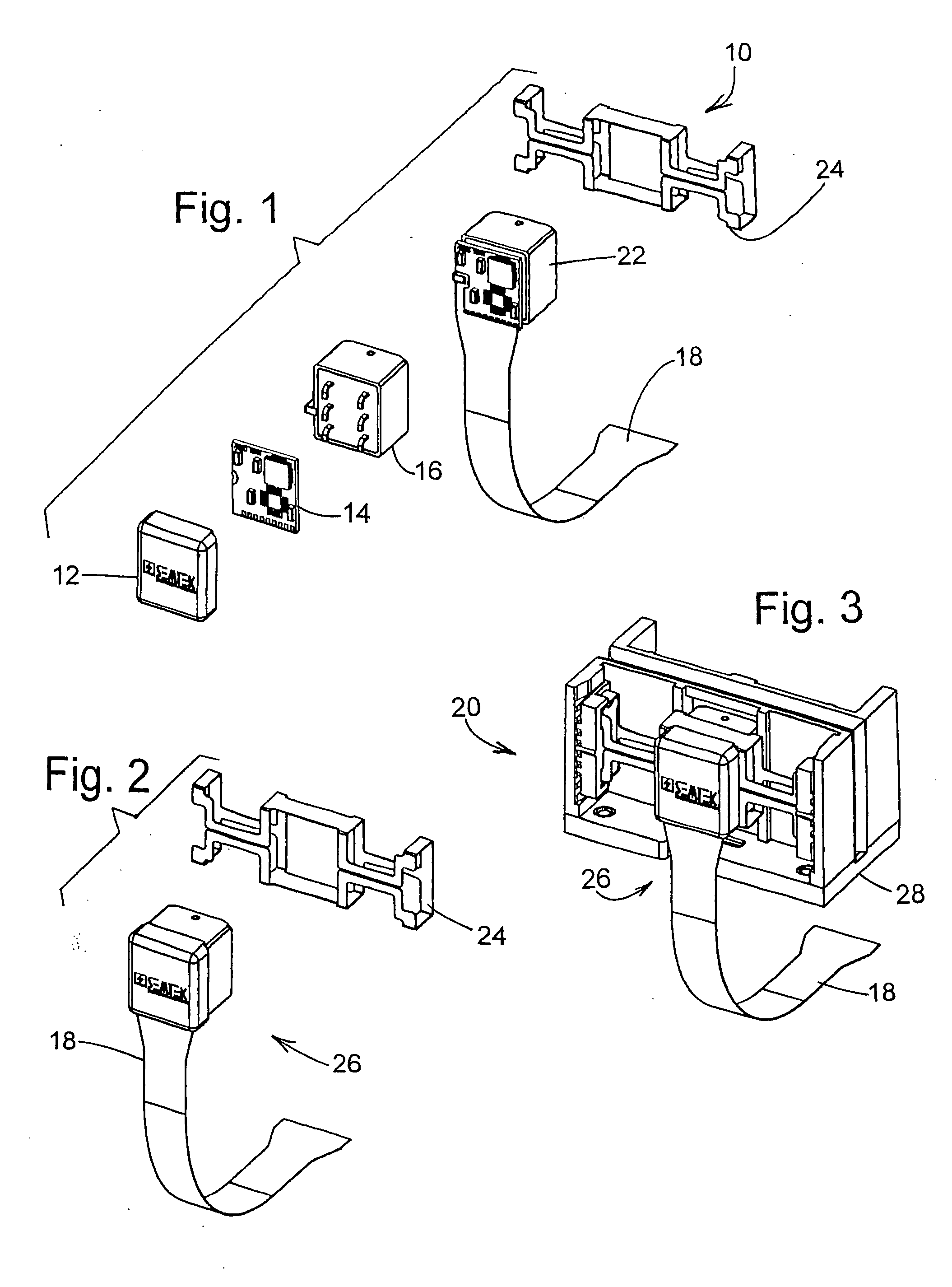

Magnetic stripe reader with power management control for attachment to a PDA device

InactiveUS20050247787A1Easy to operateIncrease powerVolume/mass flow measurementPower supply for data processingEngineeringField service

A magnetic stripe card manual swipe reader (MSR) unit capable of attaching to and communicating with a conventional personal digital assistant (PDA) from various manufacturers, using only the electrical power available as supplied by the PDA device, and capable of effective electrical power management and conservation operations. Additionally, this PDA attachable MSR unit is capable of recognizing multiple magnetic encoding formats and data record formats and converting said formats to a standardized output format, includes the capability of updating and adding new formats while in field service, and is readily allows verifying card data and encoding sensitive material prior to transmission to the PDA. These custom formats can then be used to fulfill current needs in age verification, law enforcement, security, and numerous other applications.

Owner:VERIFONE INC

Dynamic credit card with magnetic stripe and embedded encoder and methods for using the same to provide a copy-proof credit card

A dynamic credit card is provided in which a secure credit card number (e.g., a secret / hidden credit card number) is encoded based on a timing signal (e.g., an internal counter) to provide a dynamic credit card number. This dynamic number may be displayed to a user via a display (e.g., so that online purchases can be made) or written onto a magnetic stripe such that the number may be processed by traditional credit card merchants (e.g., swiped). At a remote facility, the dynamic number may be decoded based on time (and / or a counter / key number / equation) or the facility may have the secure number and perform the same function as the dynamic credit card (e.g., encode using time data as a parameter to the encoding equation) and compare the resultant dynamic number to the dynamic number received. Thus, a dynamic credit card number may change continually or periodically (e.g., every sixty seconds) such that credit card numbers may not be copied by thieves and used at later times. A dynamic verification code may be utilized in addition to, or in lieu of, a dynamic credit card number.

Owner:DYNAMICS

Programmable magnetic data storage card

ActiveUS7044394B2Reduce financial riskSimple and inexpensive and effectiveAcutation objectsApparatus for flat record carriersMicrocomputerComing out

A payment card comprises a plastic card with a magnetic stripe for user account data. Internal to the plastic card, and behind the magnetic stripe, a number of fixed-position magnetic write heads allow the user account data to be automatically modified. For example, a data field that counts the number of times the card has been scanned is incremented. A payment processing center keeps track of this usage-counter data field, and will not authorize transaction requests that come out of sequence. For example, as can occur from a magnetic clone of a card that has been skimmed and tried later. A card-swipe detector embedded in the plastic card detects each use in a scanner, and it signals an internal microcomputer which changes data bits sent to the write heads. Once scanned, the payment card can also disable any reading of the user account data for a short fixed period of time.

Owner:FITBIT INC

Dynamic credit card with magnetic stripe and embedded encoder and methods for using the same to provide a copy-proof credit card

A dynamic credit card is provided in which a secure credit card number (e.g., a secret / hidden credit card number) is encoded based on a timing signal (e.g., an internal counter) to provide a dynamic credit card number. This dynamic number may be displayed to a user via a display (e.g., so that online purchases can be made) or written onto a magnetic stripe such that the number may be processed by traditional credit card merchants (e.g., swiped). At a remote facility, the dynamic number may be decoded based on time (and / or a counter / key number / equation) or the facility may have the secure number and perform the same function as the dynamic credit card (e.g., encode using time data as a parameter to the encoding equation) and compare the resultant dynamic number to the dynamic number received. Thus, a dynamic credit card number may change continually or periodically (e.g., every sixty seconds) such that credit card numbers may not be copied by thieves and used at later times. A dynamic verification code may be utilized in addition to, or in lieu of, a dynamic credit card number.

Owner:MULLEN JEFFREY D

Secure smart card system

ActiveUS20110140841A1Electric signal transmission systemsImage analysisComputer terminalMagnetic field

A smart card usable in magnetic stripe swipe transactions with a transaction terminal configured to read transaction information encoded on a magnetic stripe of a standard transaction card includes a card body, which includes a magnetic stripe emulator for use with the transaction terminal, a smart card chip programmed with at least one transaction application for providing secured data for use in a transaction and dynamic card verification data, a power supply, and a card controller in communication with the magnetic stripe emulator. The card controller is configured to receive the dynamic card verification data and control the magnetic stripe emulator to emit a magnetic field encoded with at least a portion of the secured data and the dynamic card verification data.

Owner:X CARD HLDG

Card reader device for a cell phone and method of use

InactiveUS7810729B2Devices with card reading facilityPayment architectureMicrophone amplifierData storing

A card reader device for reading a card having data stored on a magnetic stripe incorporated into the card is disclosed in which the card reader device comprises a read head for passing a magnetic stripe of a card by to read data stored on a magnetic stripe and for producing a signal indicative of data stored on a magnetic stripe, a signal setting device for setting an amplitude of the signal indicative of data stored on a magnetic stripe, and an output jack adapted to be inserted into a microphone input associated with a cell phone for providing the signal indicative of data stored on a magnetic stripe to a cell phone. Data stored on the card and sensed by the card reader device is decoded by components such as a microphone amplifier, an analog to digital converter, and a microprocessor already resident in a cell phone.

Owner:REM HLDG 3

Dynamic credit card with magnetic stripe and embedded encoder and methods for using the same to provide a copy-proof credit card

A dynamic credit card is provided in which a secure credit card number (e.g., a secret / hidden credit card number) is encoded based on a timing signal (e.g., an internal counter) to provide a dynamic credit card number. This dynamic number may be displayed to a user via a display (e.g., so that online purchases can be made) or written onto a magnetic stripe such that the number may be processed by traditional credit card merchants (e.g., swiped). At a remote facility, the dynamic number may be decoded based on time (and / or a counter / key number / equation) or the facility may have the secure number and perform the same function as the dynamic credit card (e.g., encode using time data as a parameter to the encoding equation) and compare the resultant dynamic number to the dynamic number received. Thus, a dynamic credit card number may change continually or periodically (e.g., every sixty seconds) such that credit card numbers may not be copied by thieves and used at later times. A dynamic verification code may be utilized in addition to, or in lieu of, a dynamic credit card number.

Owner:MULLEN JEFFREY D

Magnetic data recording device

Owner:FITBIT INC

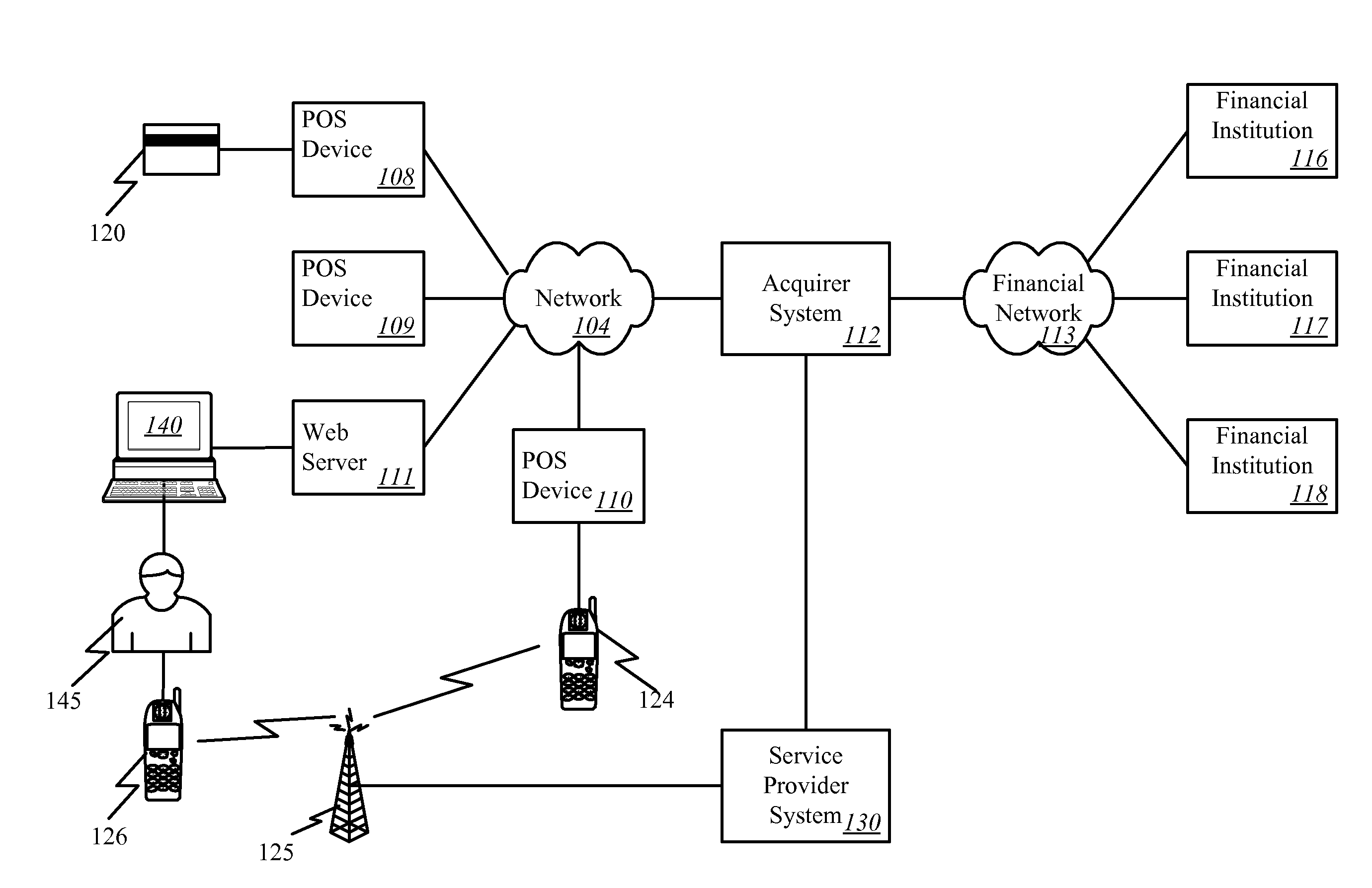

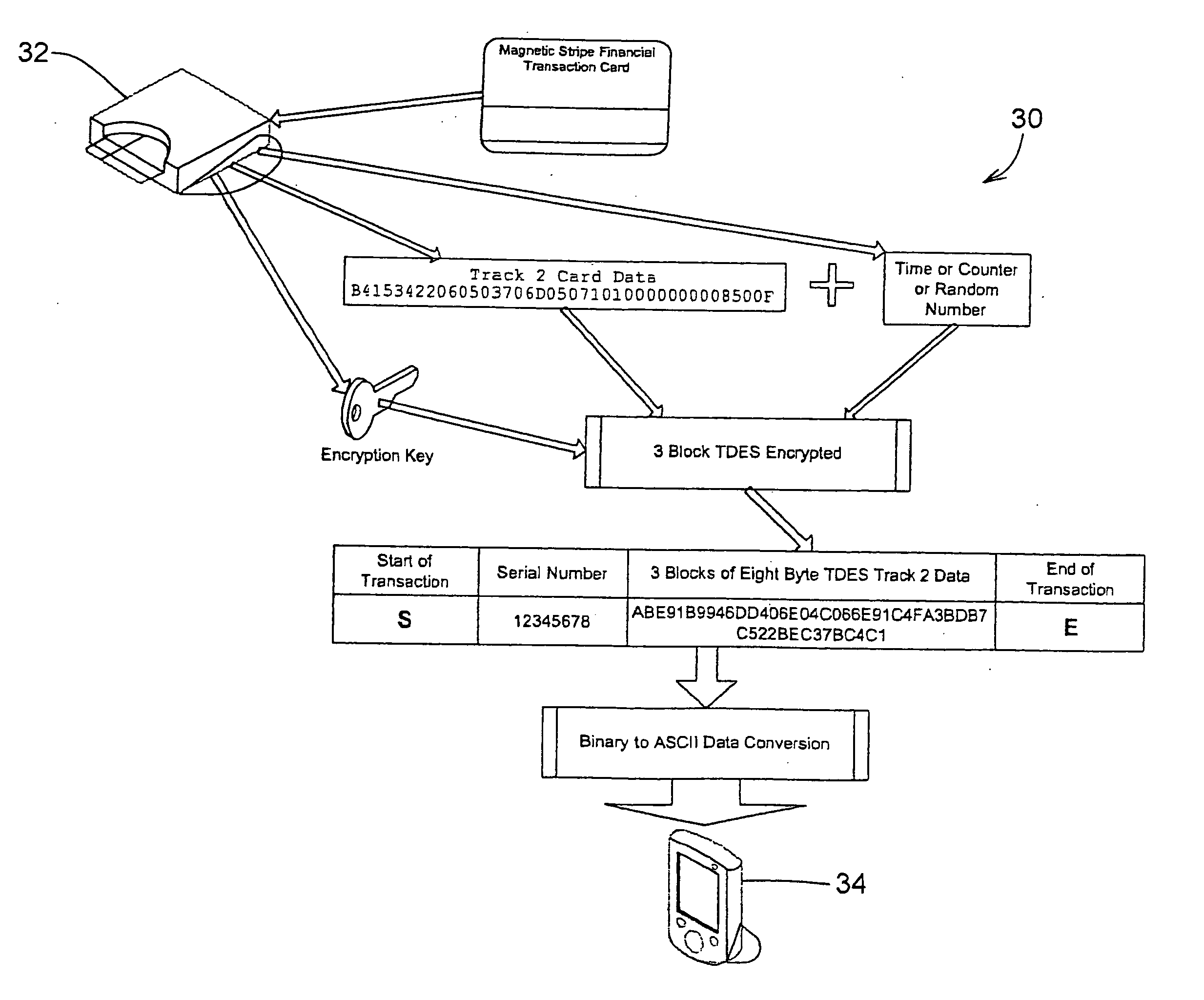

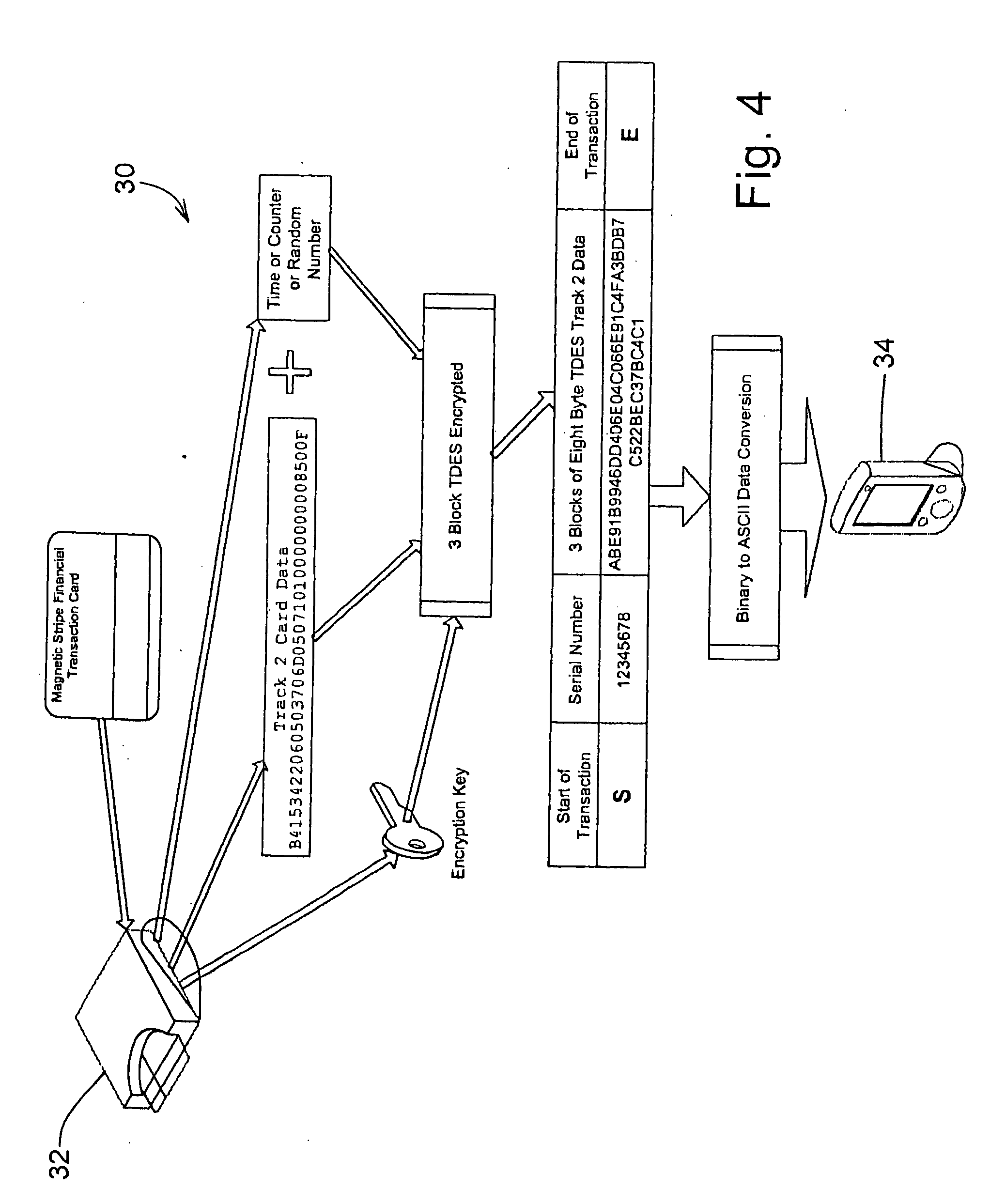

Transparently securing data for transmission on financial networks

ActiveUS20060049256A1Easy to operateIncrease powerAcutation objectsFinanceInformation processingSoftware system

A secure magnetic stripe card stripe reader (MSR) module and software system capable of encrypting the magnetic stripe data to CPI, SDP and CISP standards for use in point of sale (POS) and other applications requiring data security using non secure networks and computing devices. Additionally, when incorporated within an attachment for conventional personal digital assistant (PDA) or cell phone or stationary terminal, provides encrypted data from the magnetic head assembly providing compliance with Federal Information Processing Standards Publication Series FIPS 140 covering security and tampering standards. Moreover, this module and software system includes the capability of providing secure POS transactions to legacy transaction processing systems and POS terminals transparently to the existing infrastructure. Furthermore, this module and software system includes the capability of transparently providing detection of fraudulently copied magnetic stripe cards.

Owner:VERIFONE INC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com