Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

2097 results about "Card holder" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

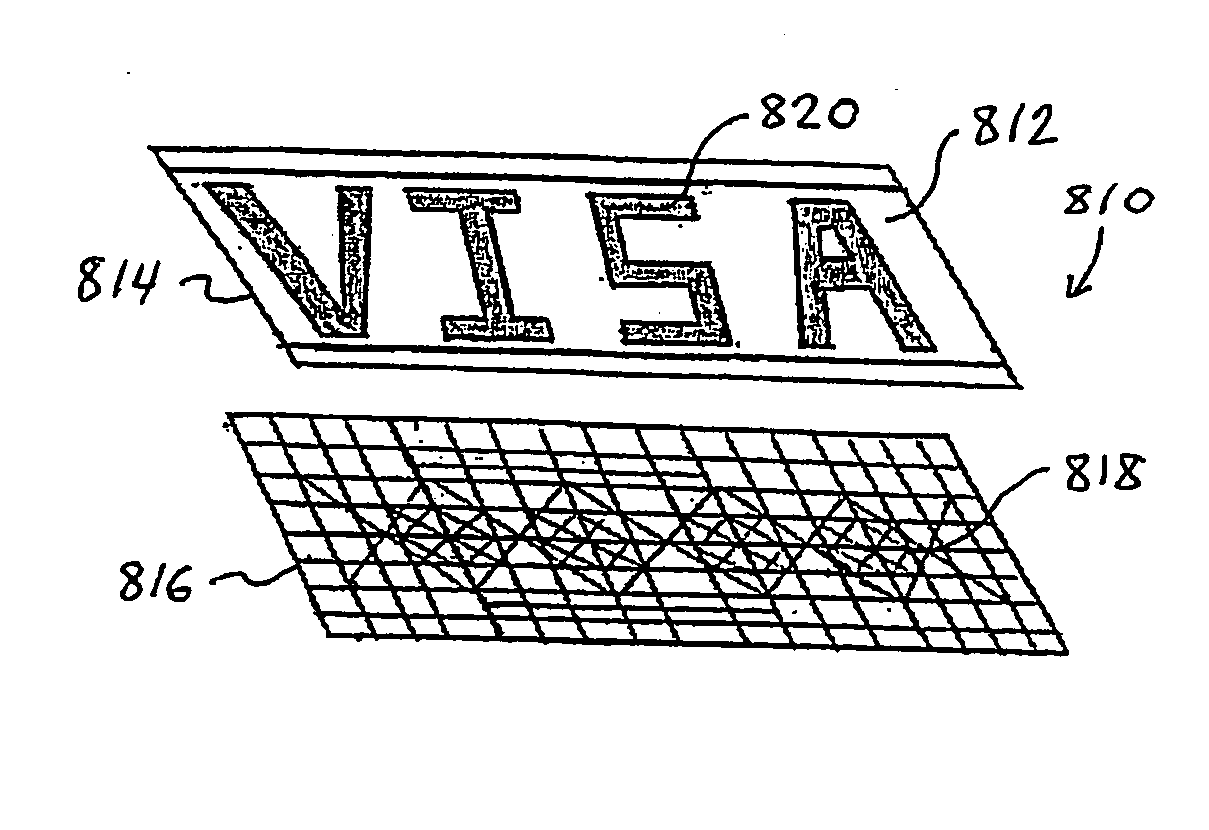

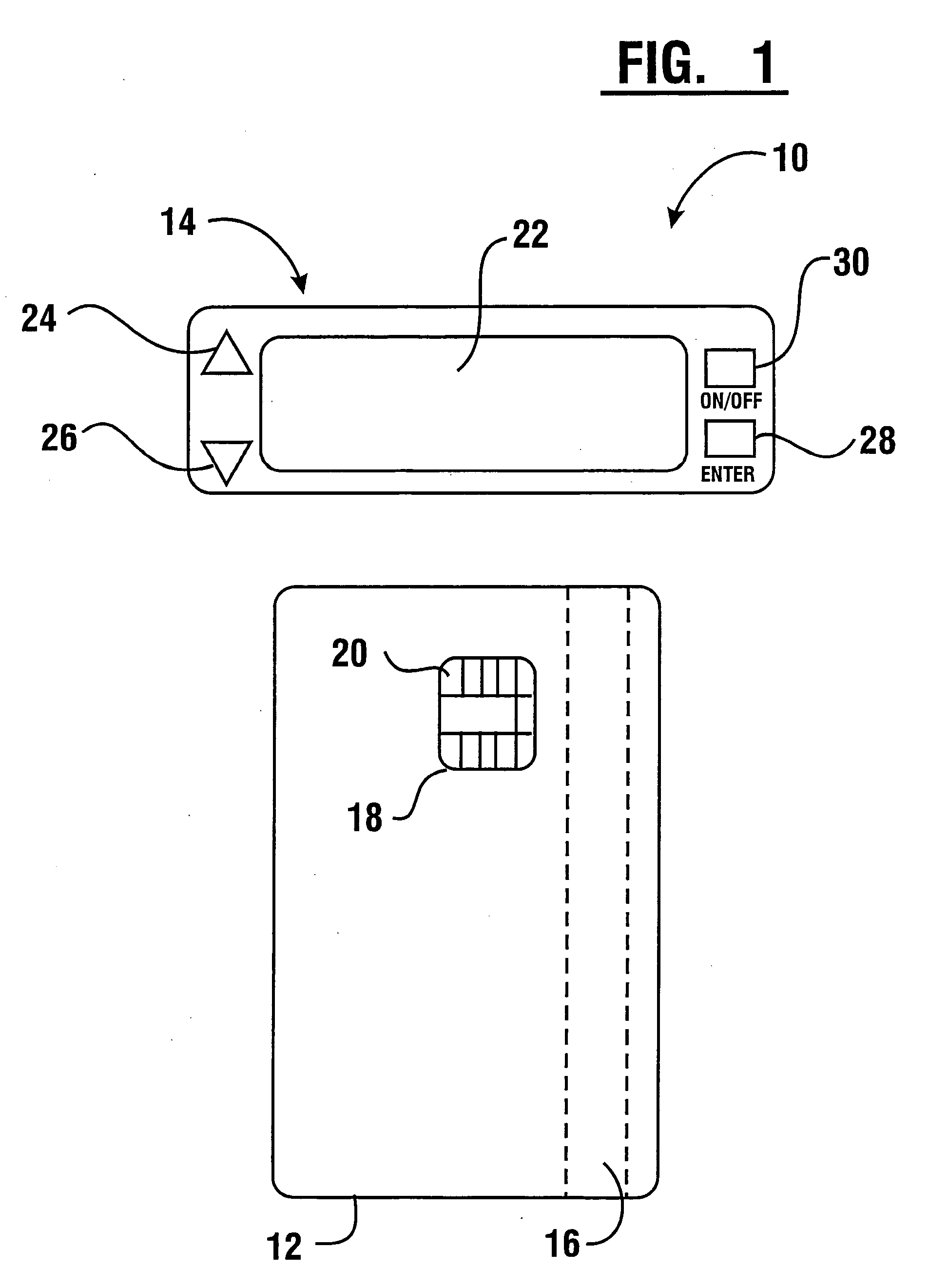

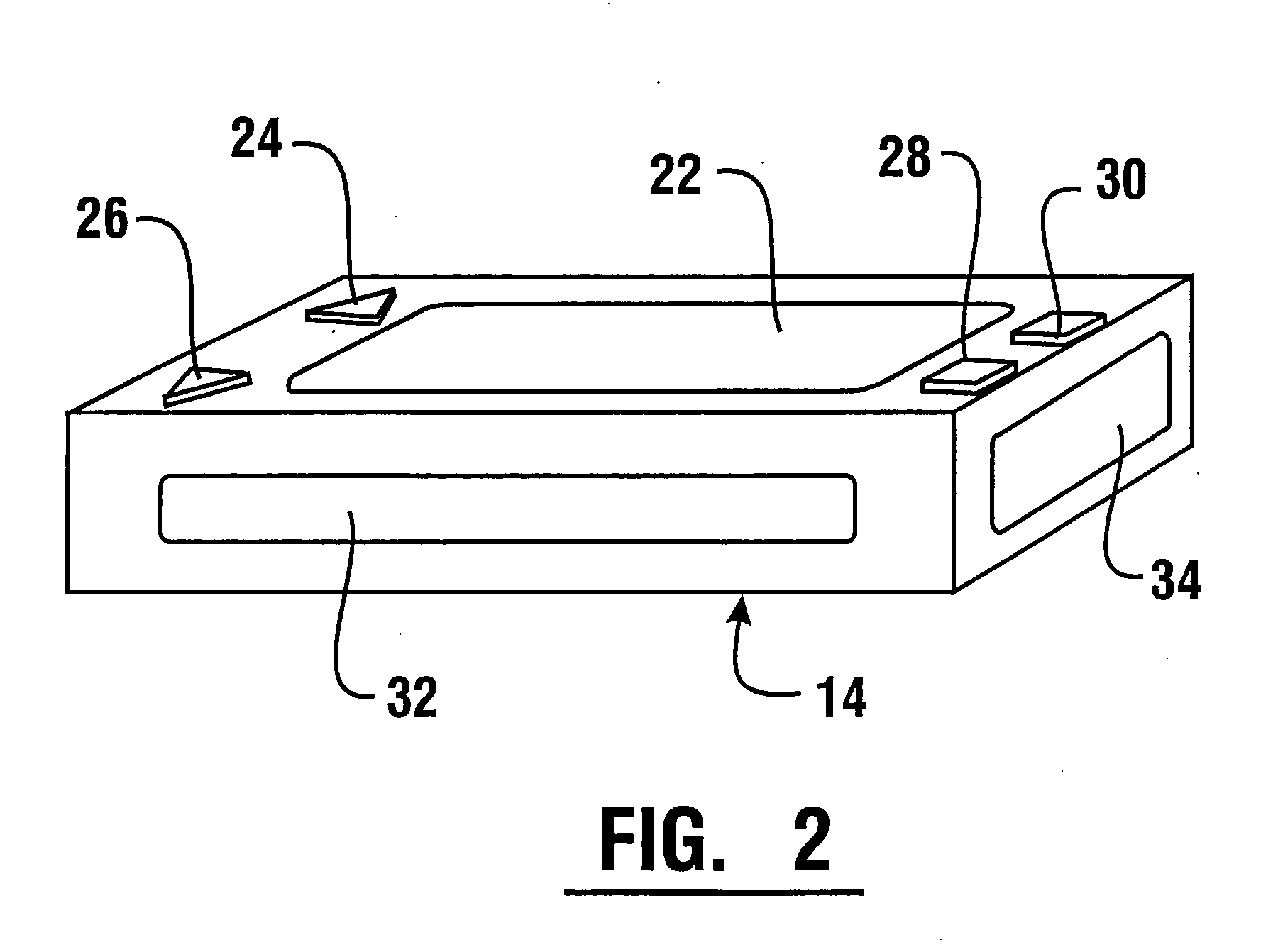

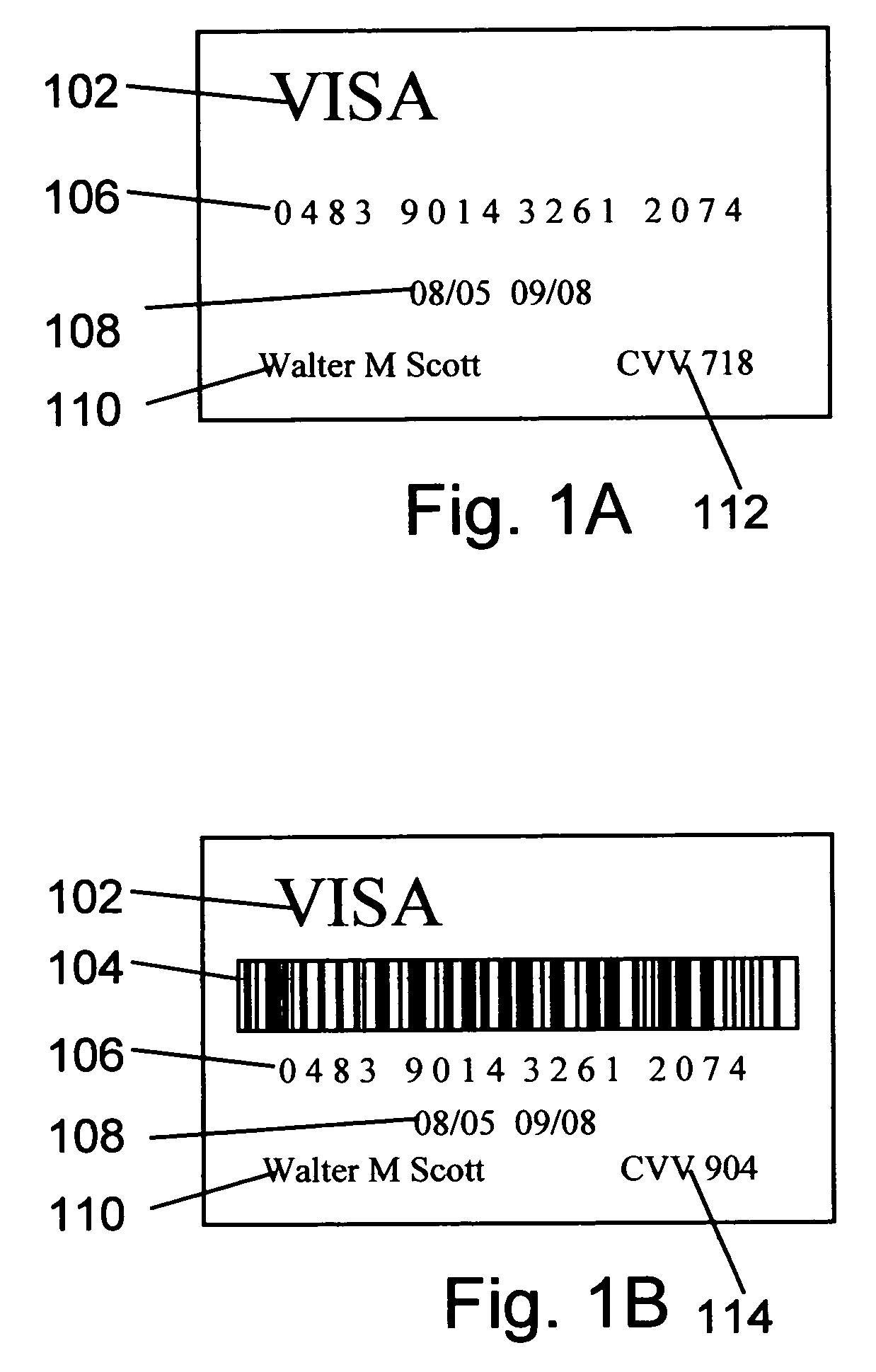

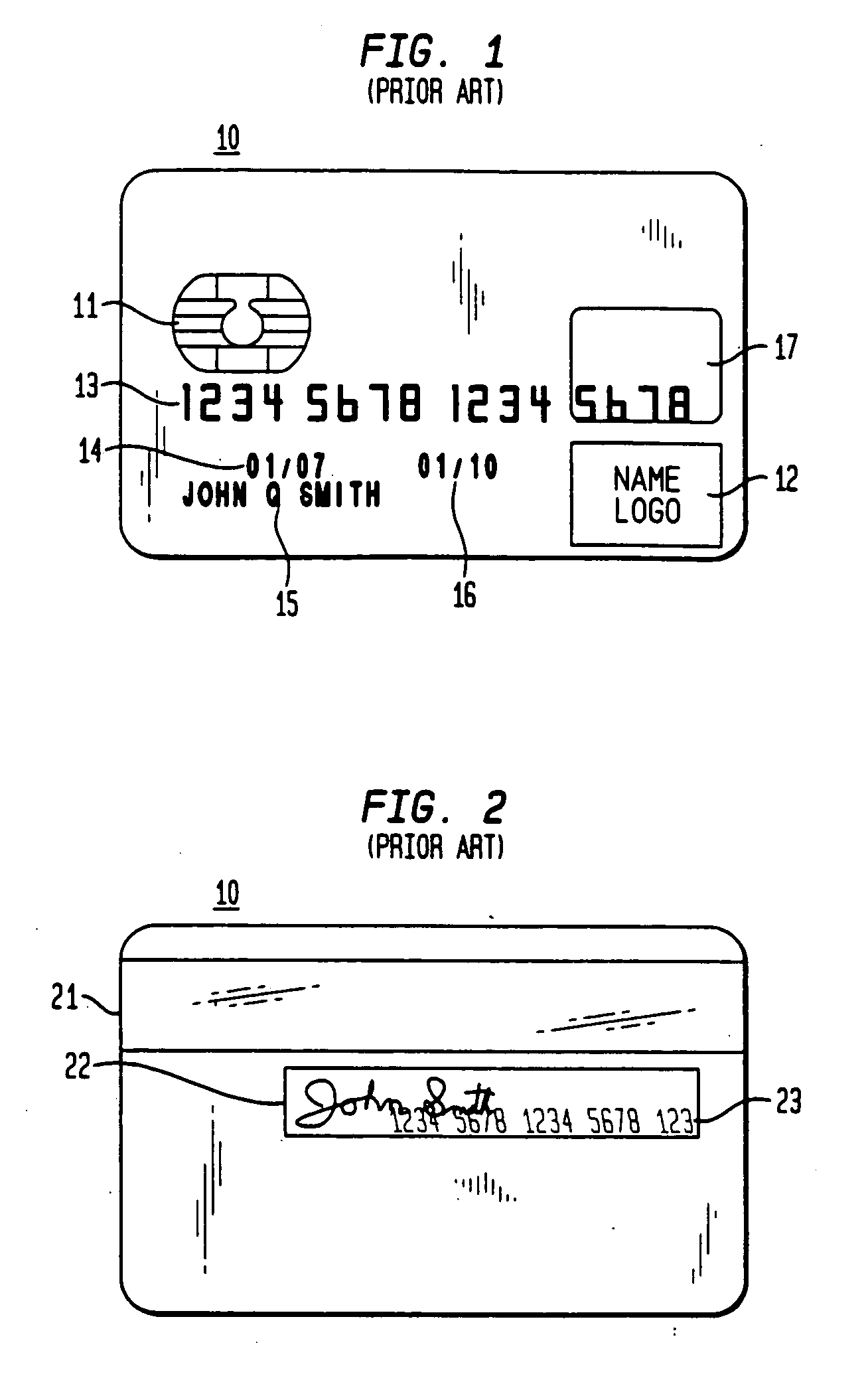

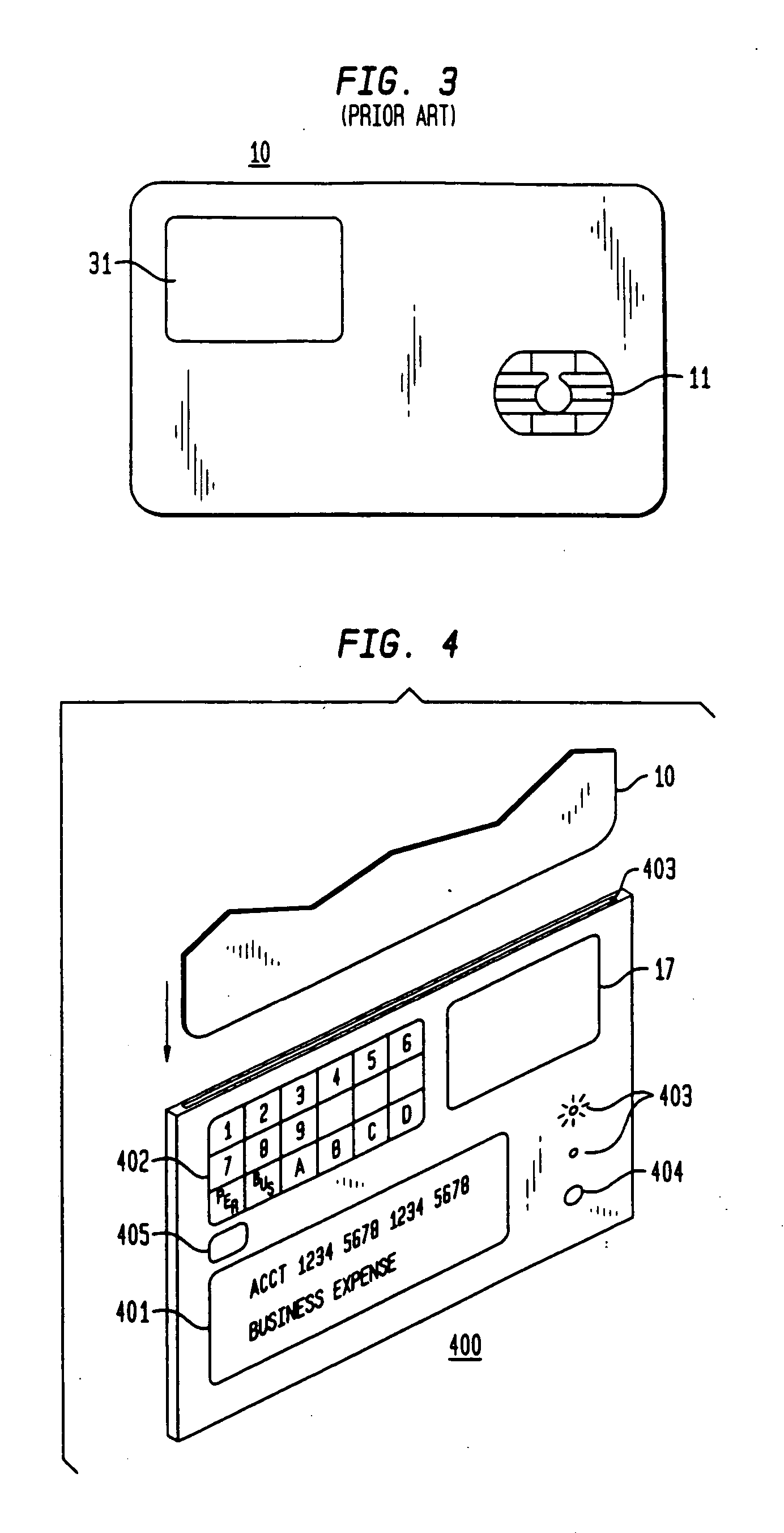

Multi-account card with magnetic stripe data and electronic ink display being changeable to correspond to a selected account

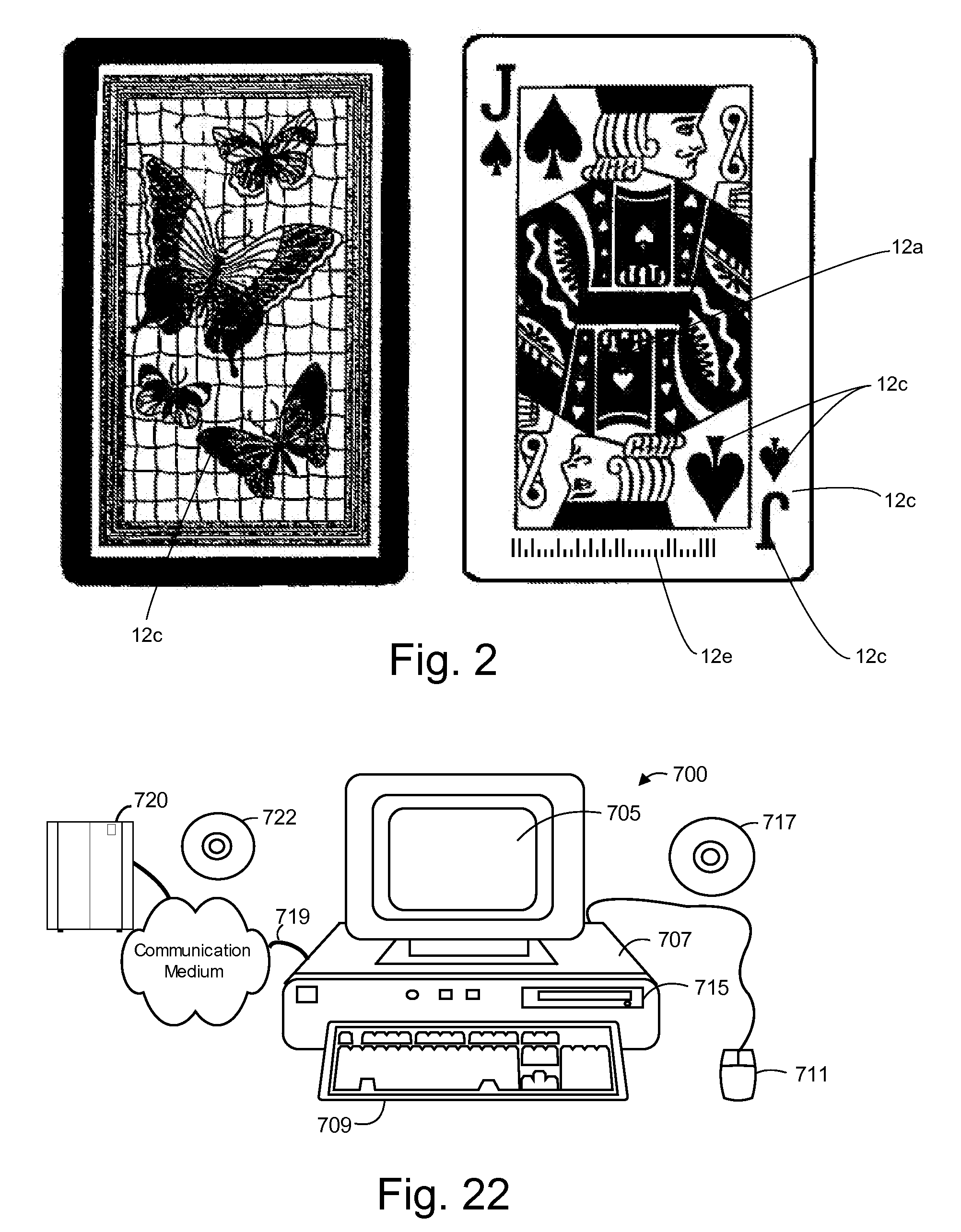

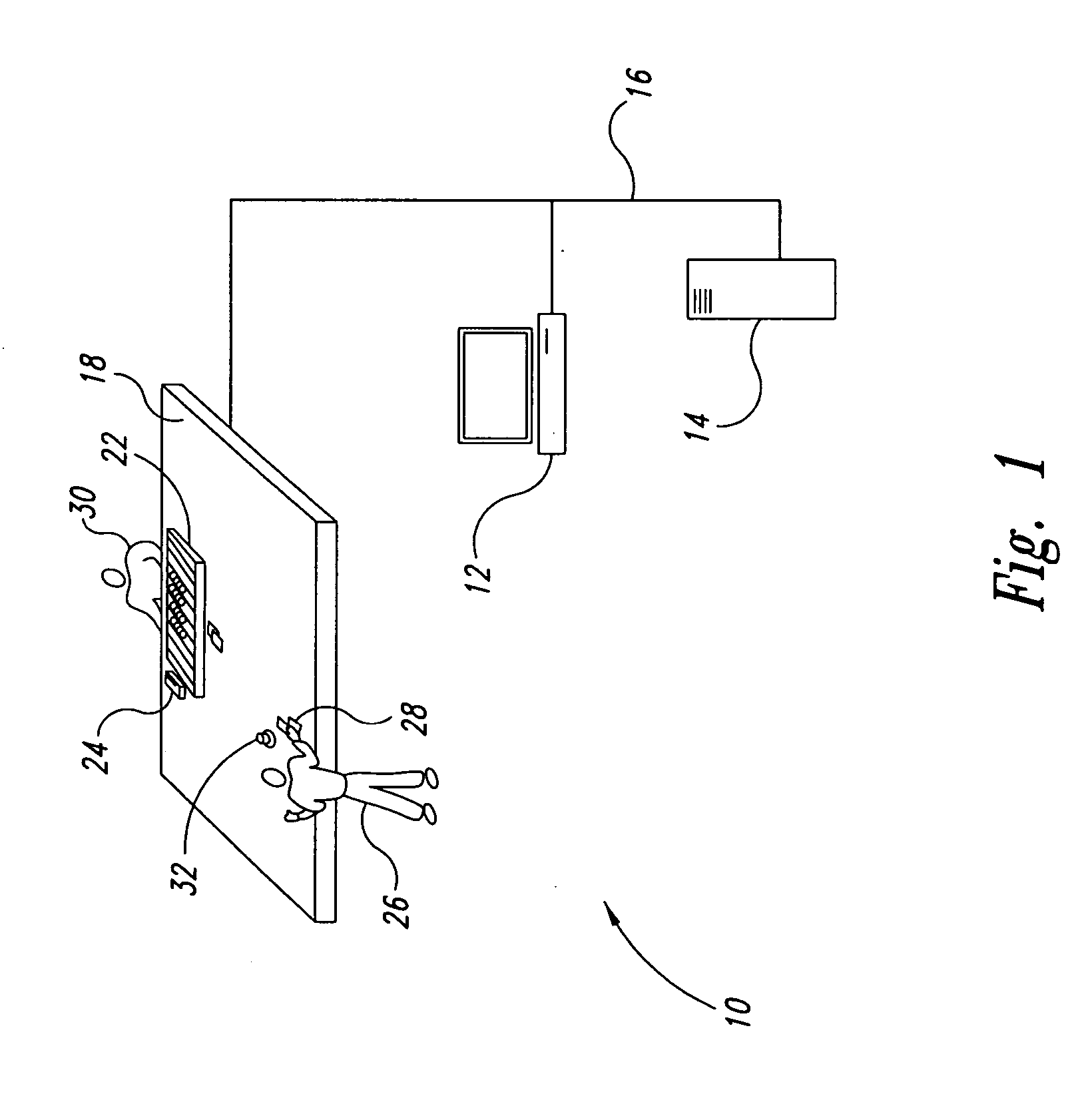

A multifunction card includes a programmable memory, a magnetic stripe, and an electronic ink display. The programmable memory is able to store corresponding account data and image data for a plurality of different accounts. The card holder is able to use a portable terminal to select one of the accounts stored in memory. The terminal is able to write account data corresponding to the selected account to the magnetic stripe of the card. The terminal is also able to electronically change the electronic ink display to the image corresponding to the selected account. Thus, a single multifunction card, with the ability to have both its magnetic stripe data and appearance changed in accordance with a selected account, can substitute for many different cards.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

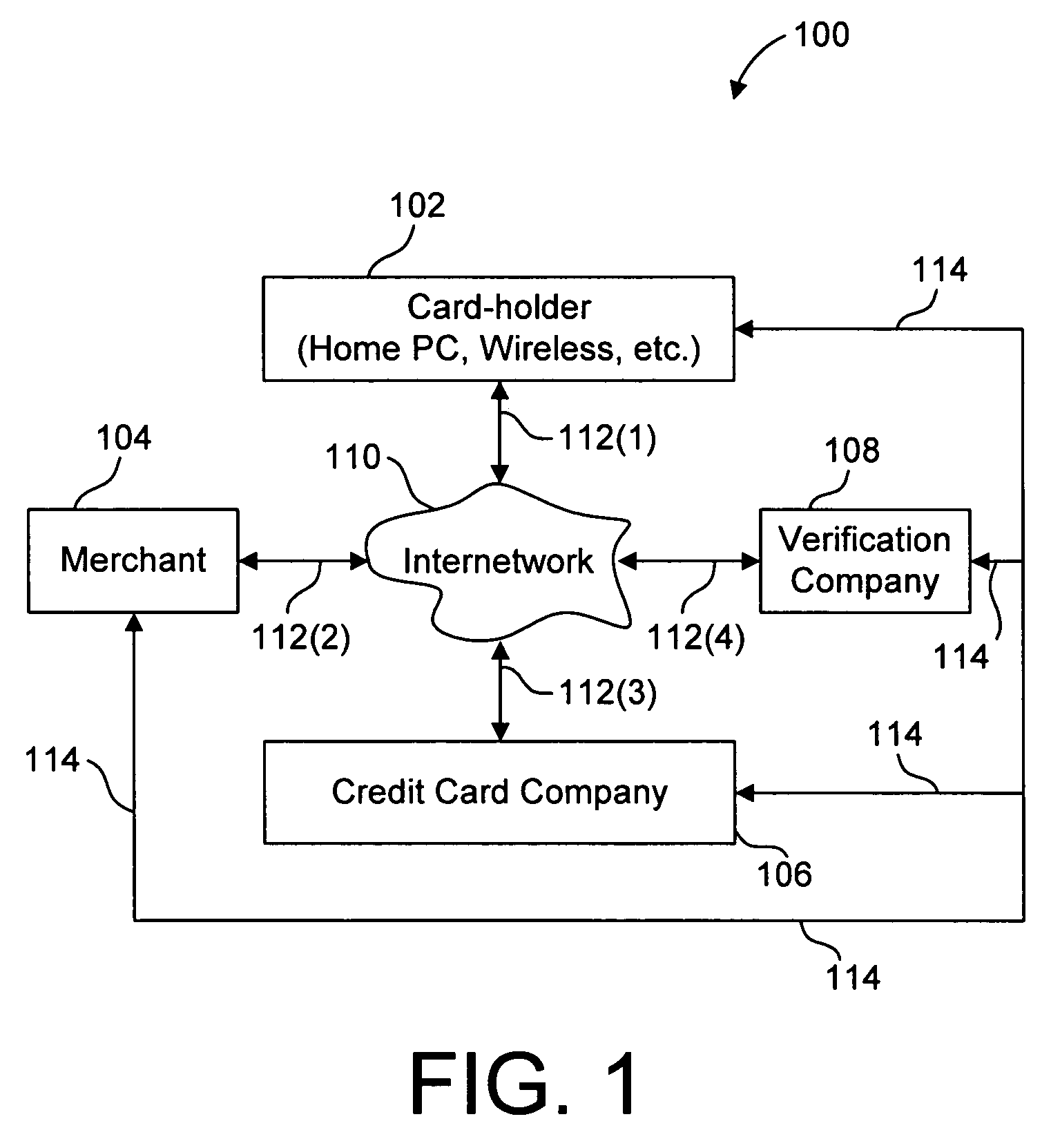

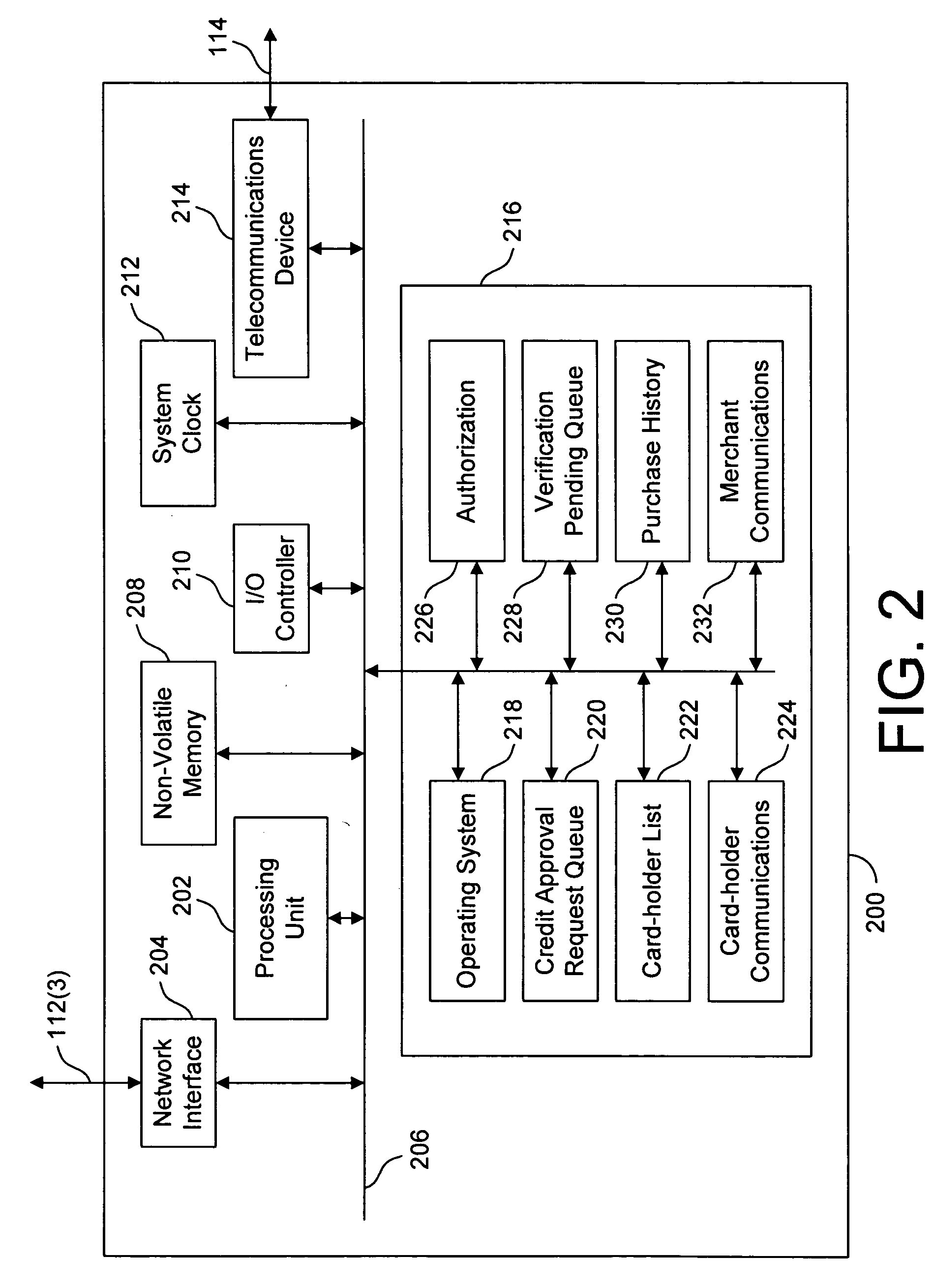

Method and apparatus for verification/authorization by credit or debit card owner of use of card concurrently with merchant transaction

A method and apparatus for protecting against the unauthorized use of a credit card called CardSafe(TM) allows the credit card holder to finally approve any credit card transaction. When a credit card is used at a remote merchant's terminal, the credit card company is notified of the transaction amount and the credit card account number. The named card holder is concurrently notified of the transaction by a wireless device, such as a telephone call, pager notification, or the like. Upon notification, the card holder can approve or disapprove of the credit card transaction. Unless approved or denied by the credit card holder, the transaction remains uncompleted. The approval or disapproval by the credit card holder can be accomplished in real time or on a pre-selected basis. An unauthorized person would not be able to complete a transaction The credit card owner can also deactivate the CardSafe(TM) system.

Owner:DURFIELD RICHARD C

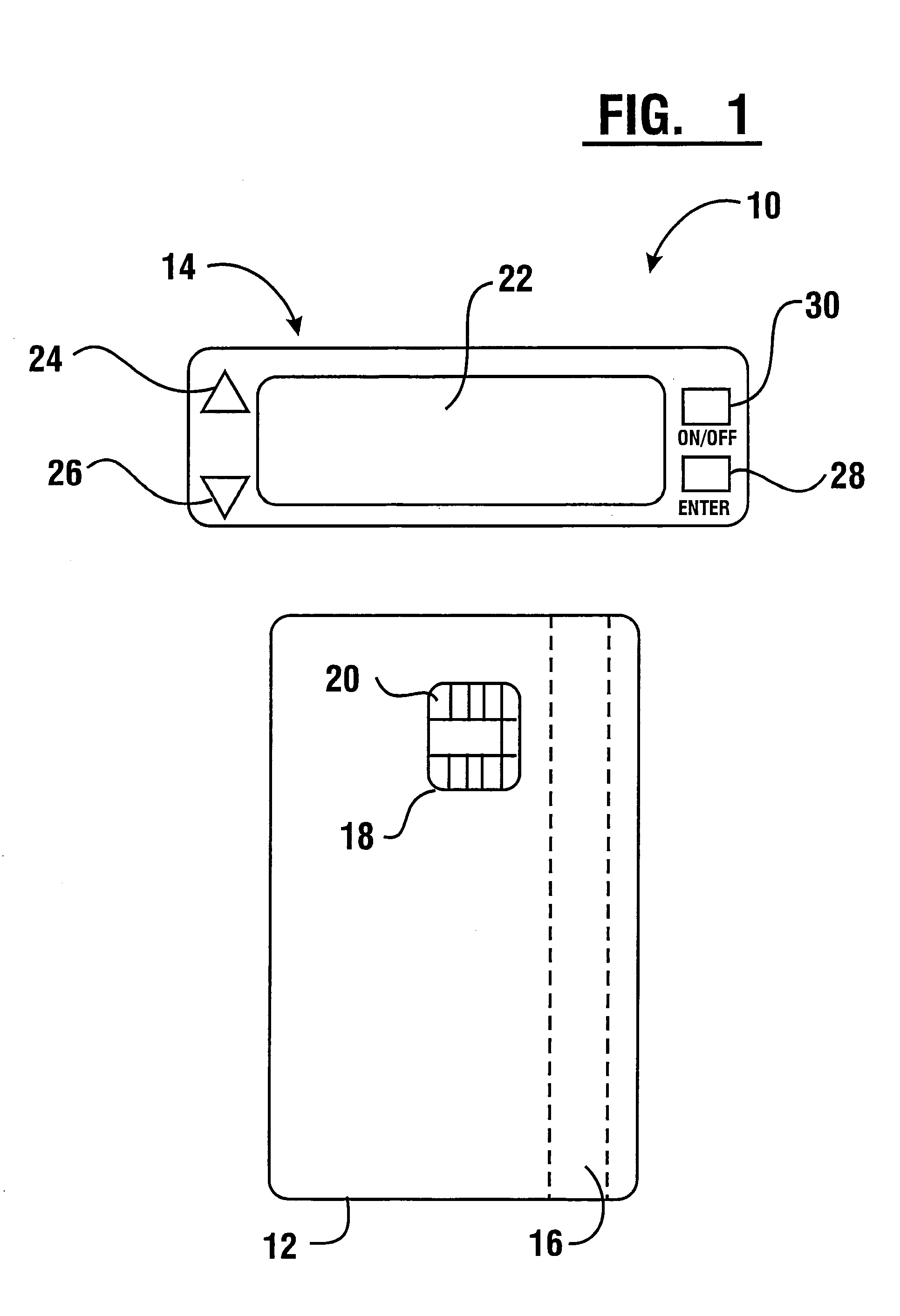

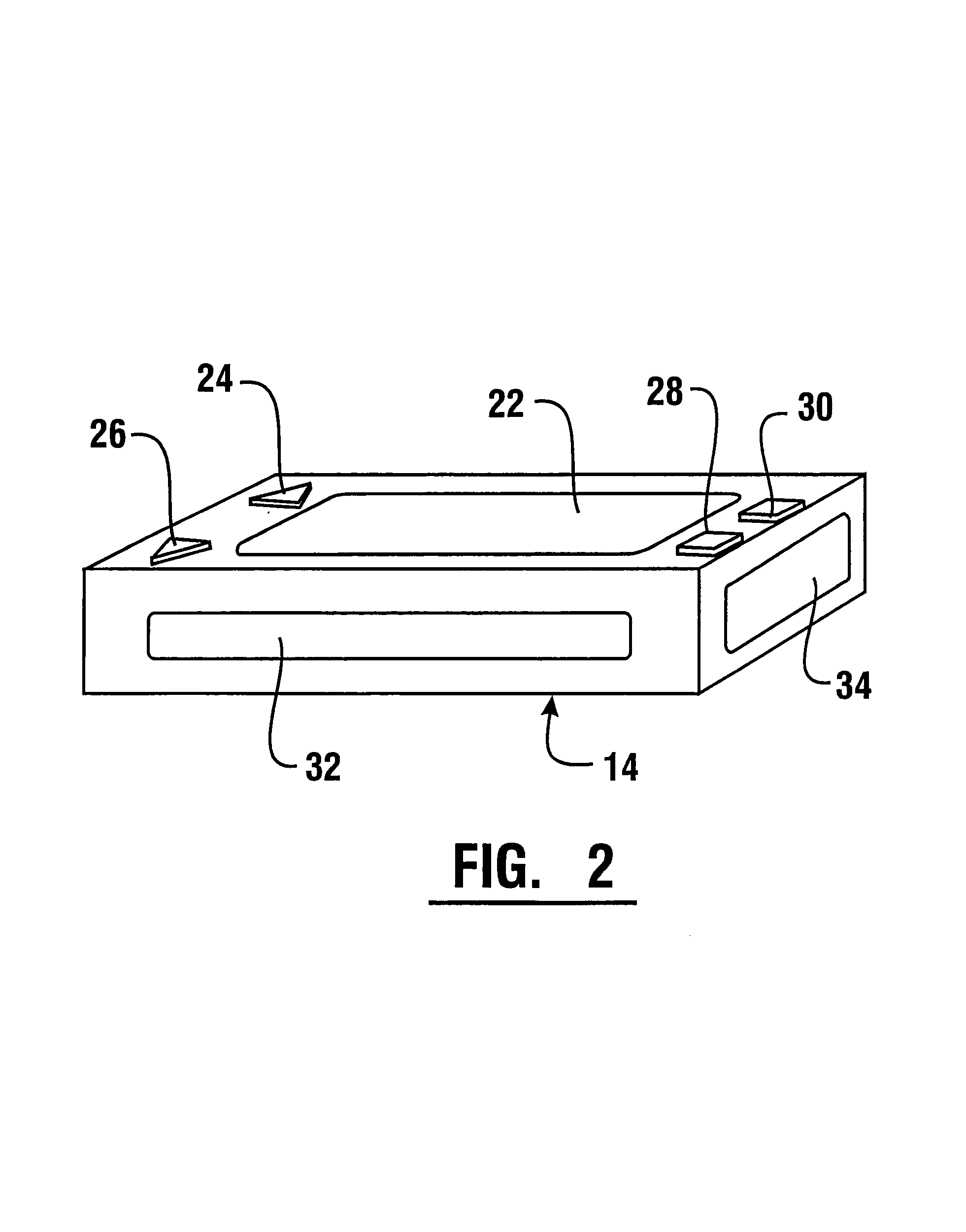

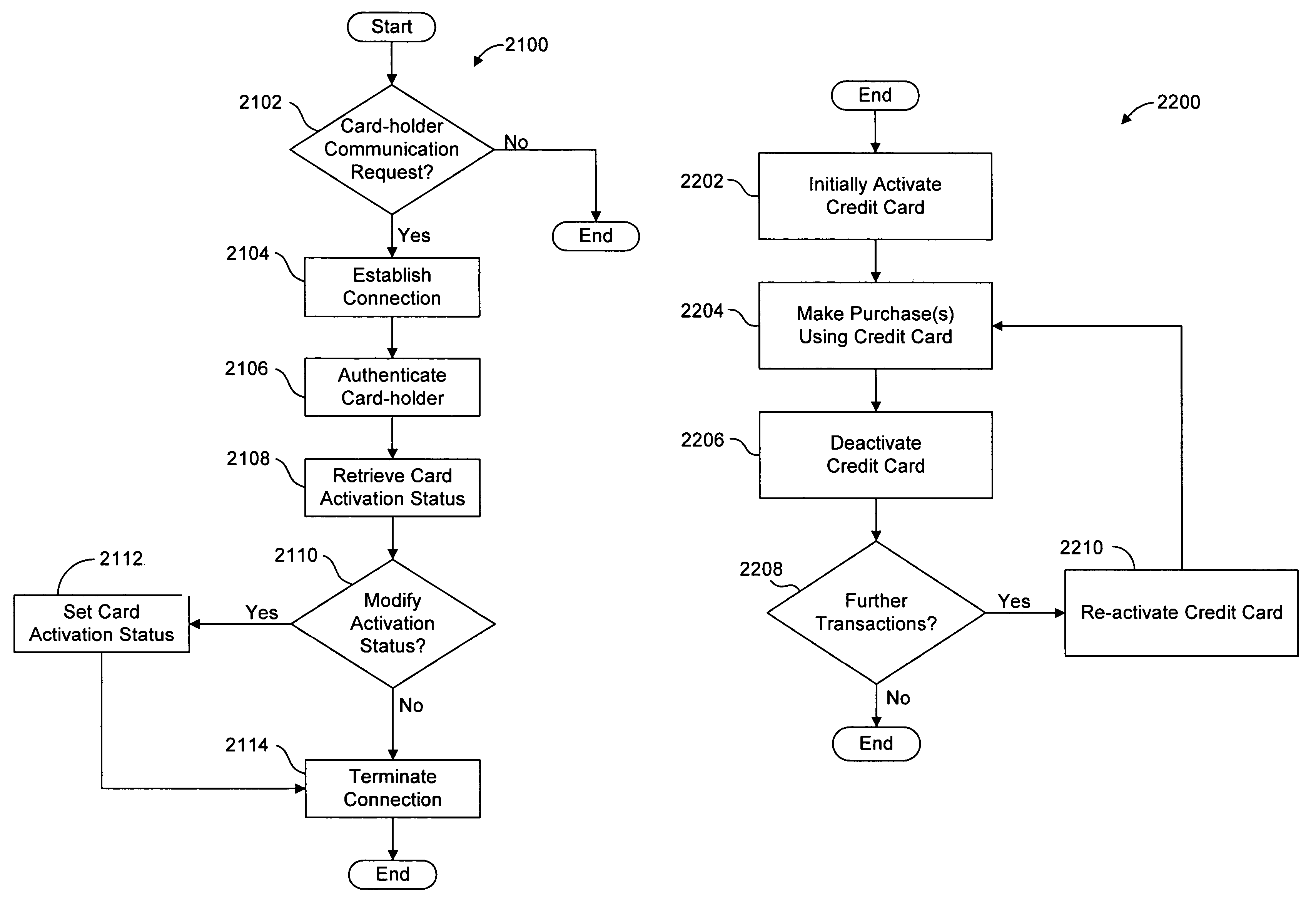

System and method for securing a credit account

ActiveUS7264154B2Facilitates card-holder verificationEliminate needComplete banking machinesFinanceCredit cardSecurity Measure

Owner:HARRIS INTPROP LP

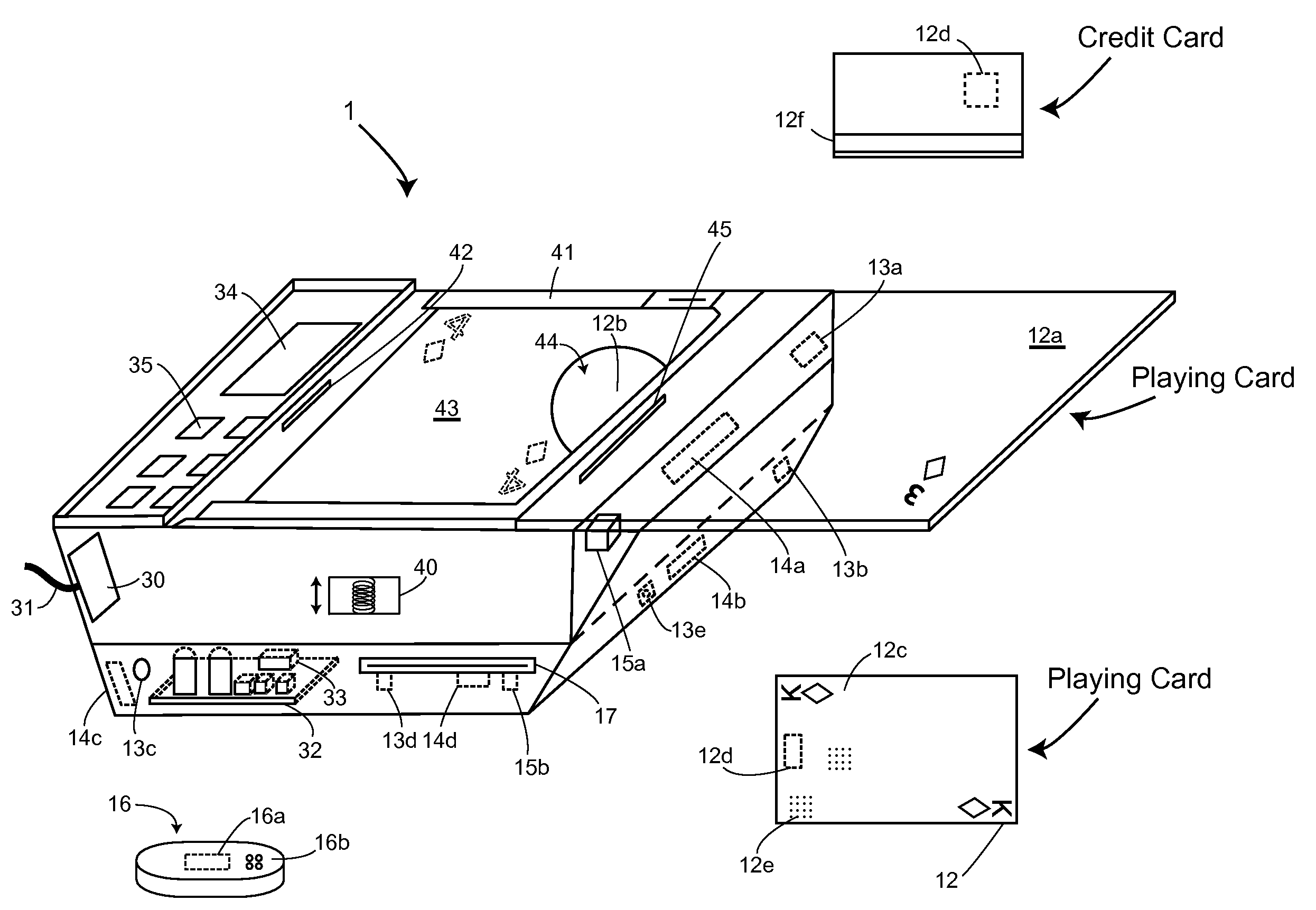

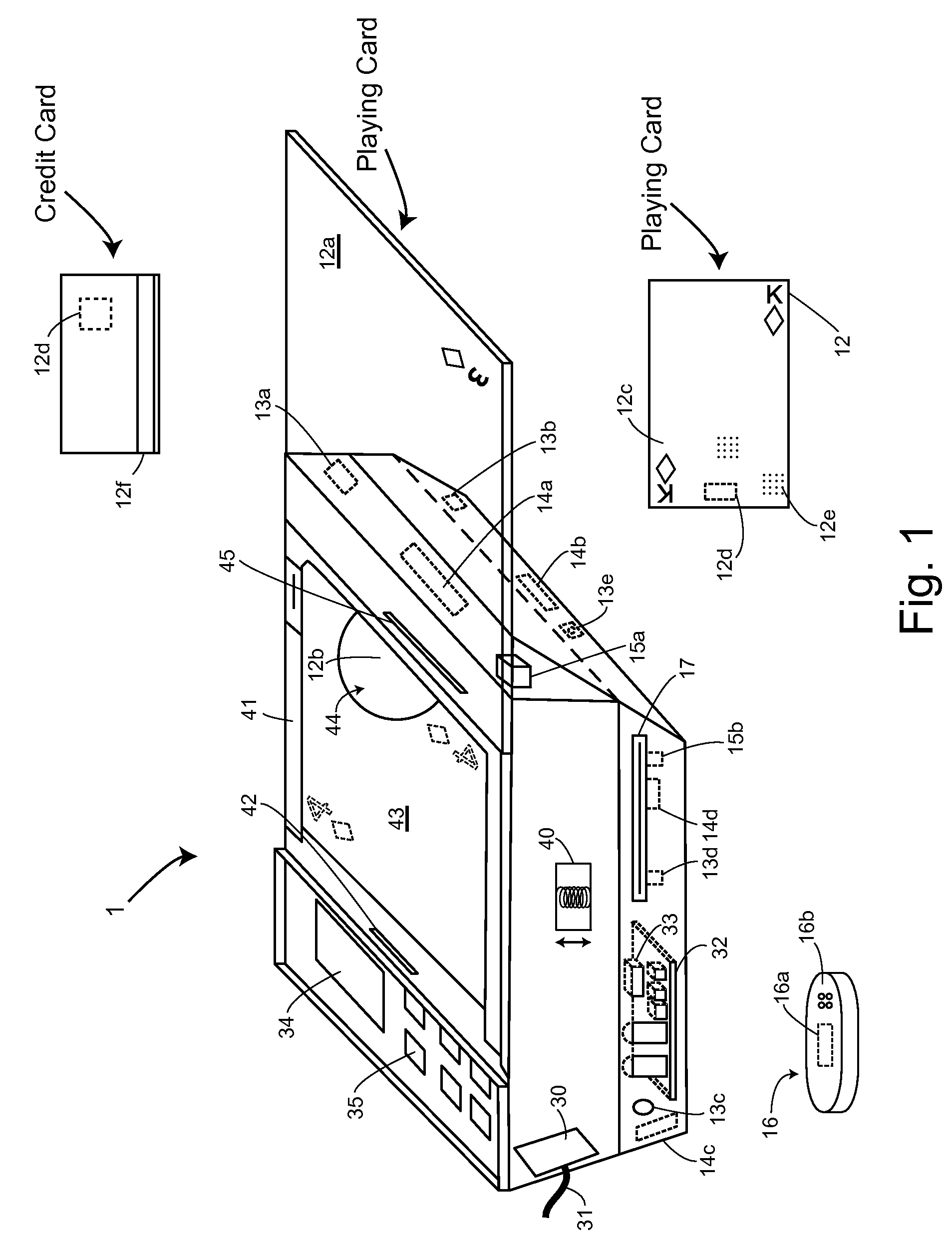

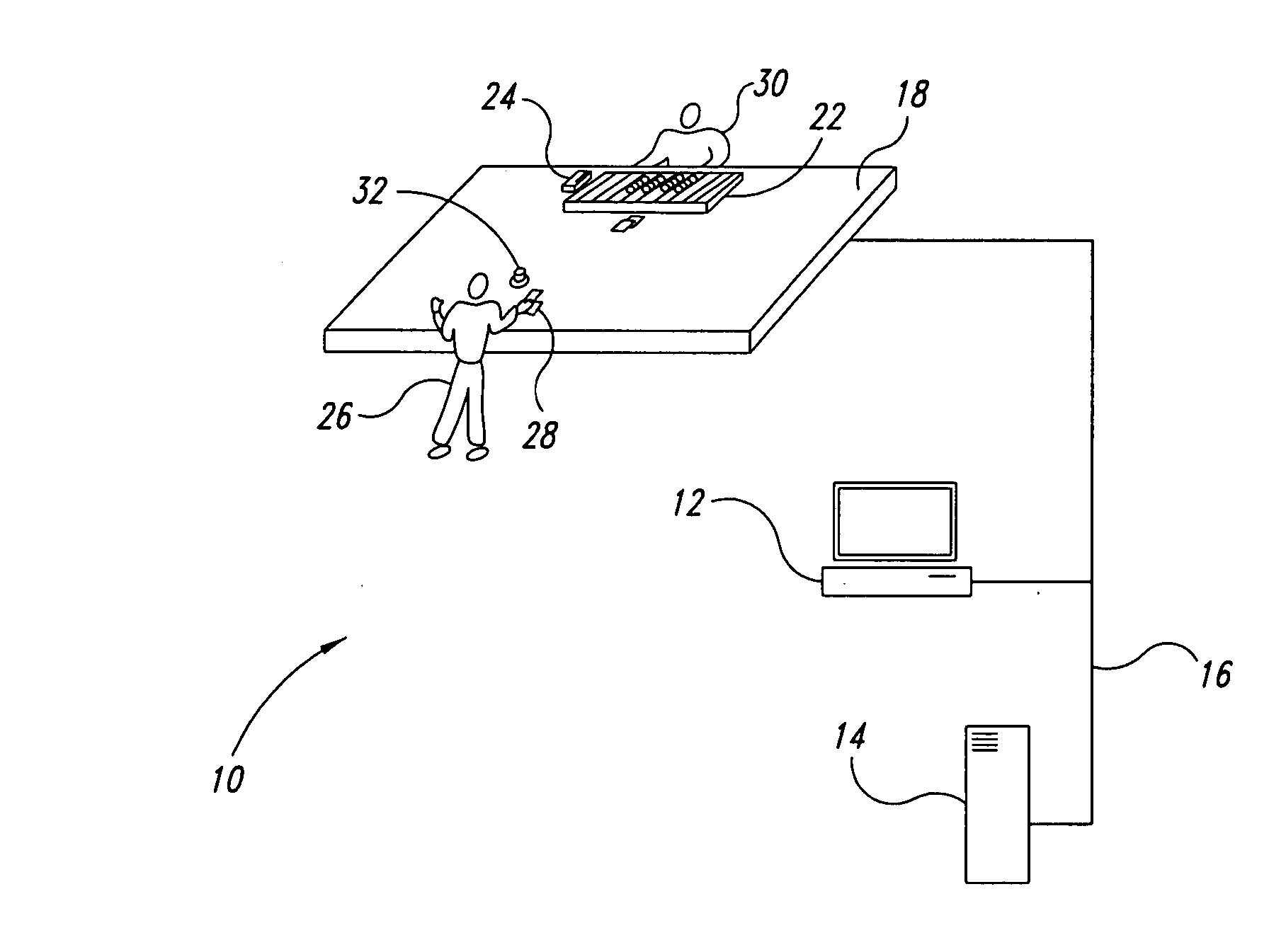

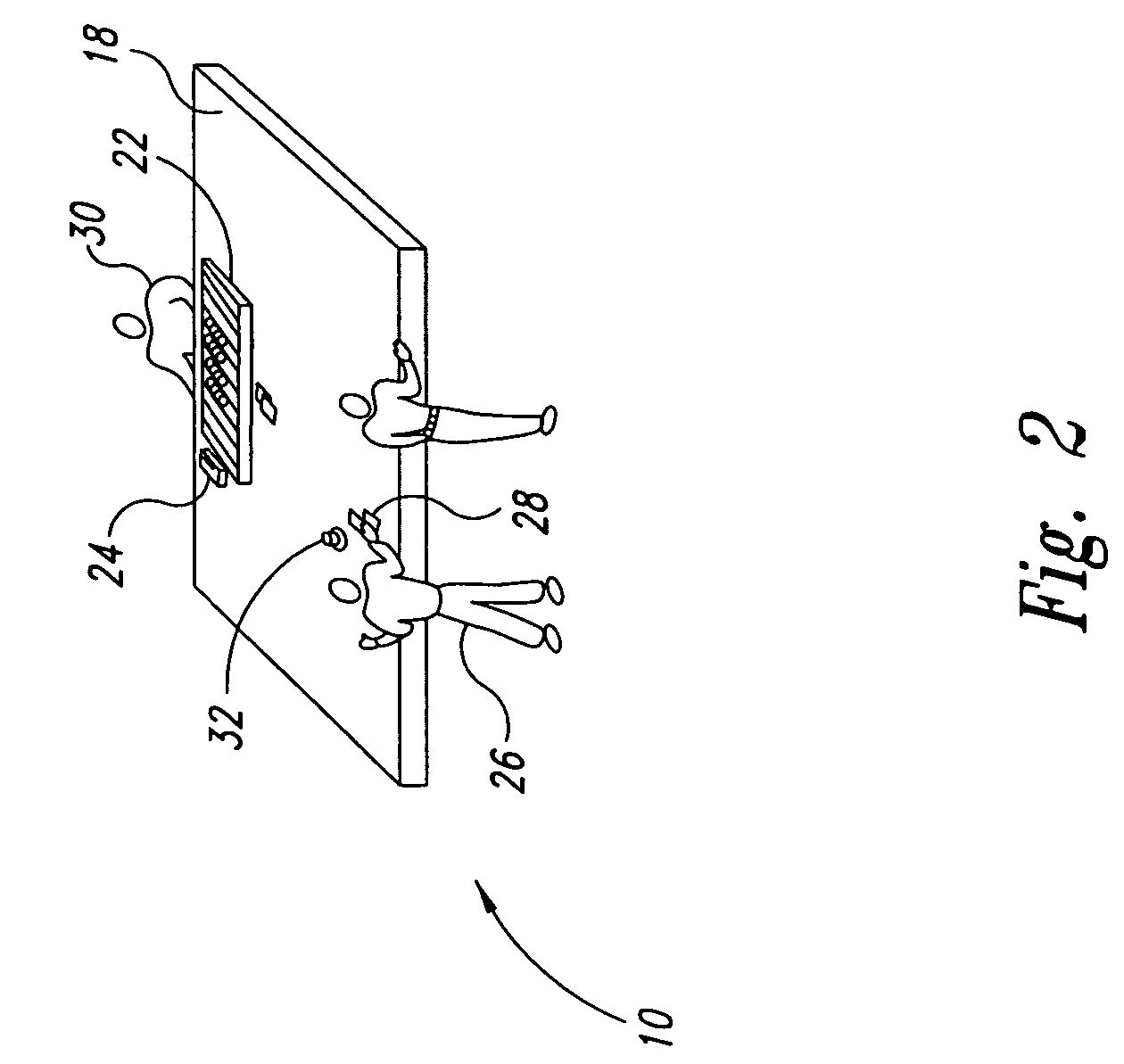

Table with sensors and smart card holder for automated gaming system and gaming cards

InactiveUS20090191933A1Low costMore secure and reliable gaming experienceCard gamesApparatus for meter-controlled dispensingHand heldSmart card

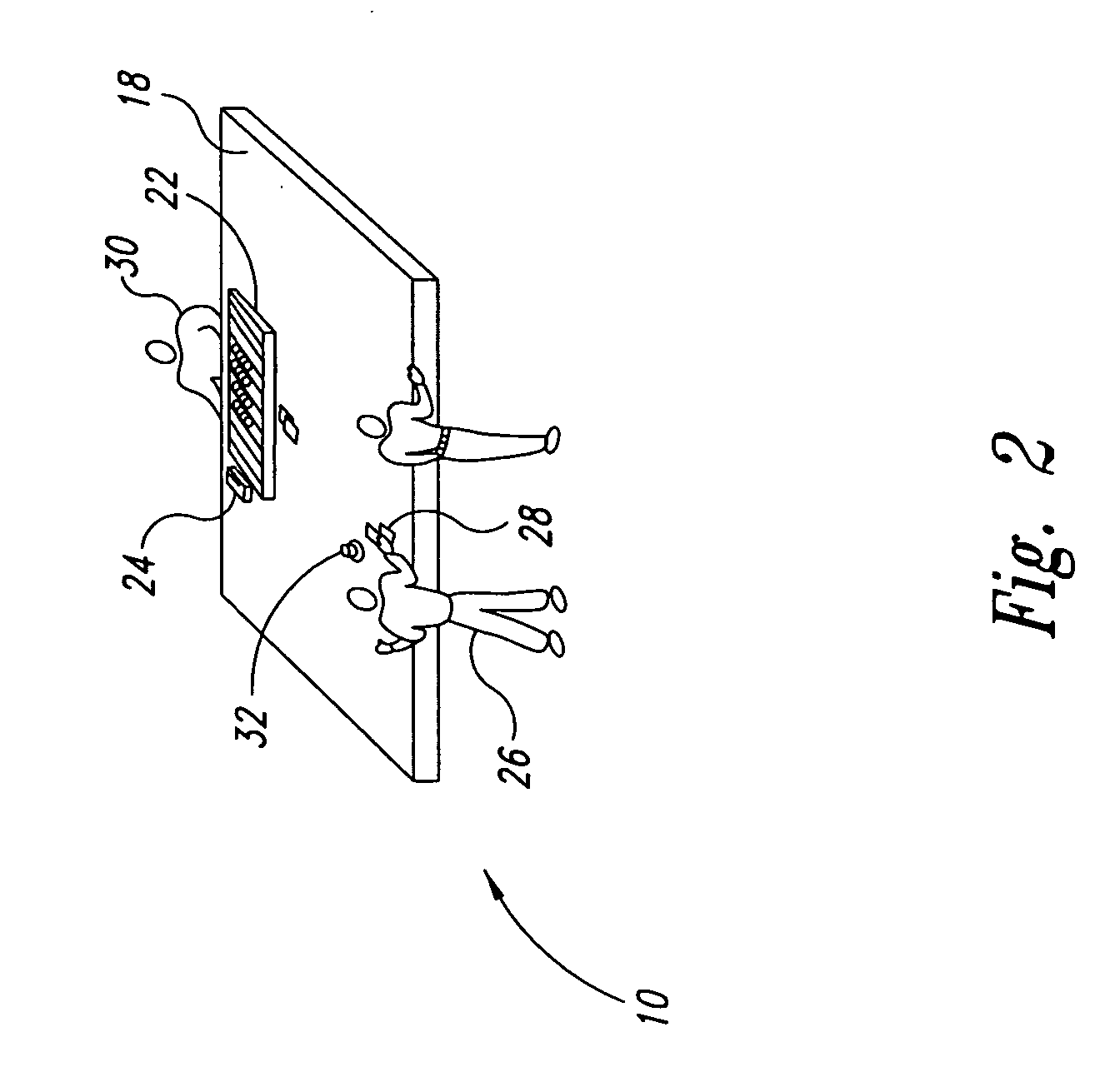

Methods and systems for intelligent tracking and / or play and / or management of card gaming use an intelligent card distribution or holding device with detectors for determining the value and unique identity of individual cards and for recording card play. Playing cards are equipped with a read / write data storage connected to a transponder and / or incorporated into electromagnetic writable particles or smart particles (smart dust). A system of the invention records various game play events on the playing cards themselves during game play and optionally also in a database on the system. In specific embodiments, the principal scanning and writing elements and electronic and optical interfaces are embodied into a hand-held card holder (HHCH). In specific embodiments, the system utilizes various types of sensors and / or indicators and / or and electronic circuits and software to scan, track, monitor, compute, and interface with electronic devices, to enable the automatic operation of Casino table games. The system can scan playing cards, scan gaming chips, indicate a players win / loss / draw, increase or decrease player betting positions, compute awards to players based on their playing activity, photograph individual players, and transmit player's images to casino security / surveillance departments and or other authorized casino personnel. The system may activate table displays that indicate each player's win / loss / draw of their bets, and / or dealers card count, indicate in the game of blackjack when a dealer has blackjack, or any other significant event that occurs such as indicating when a player has a winning / loss / draw on specific card combinations.

Owner:FRENCH JOHN B

Method and system for identity and know your customer verification through credit card transactions in combination with internet based social data

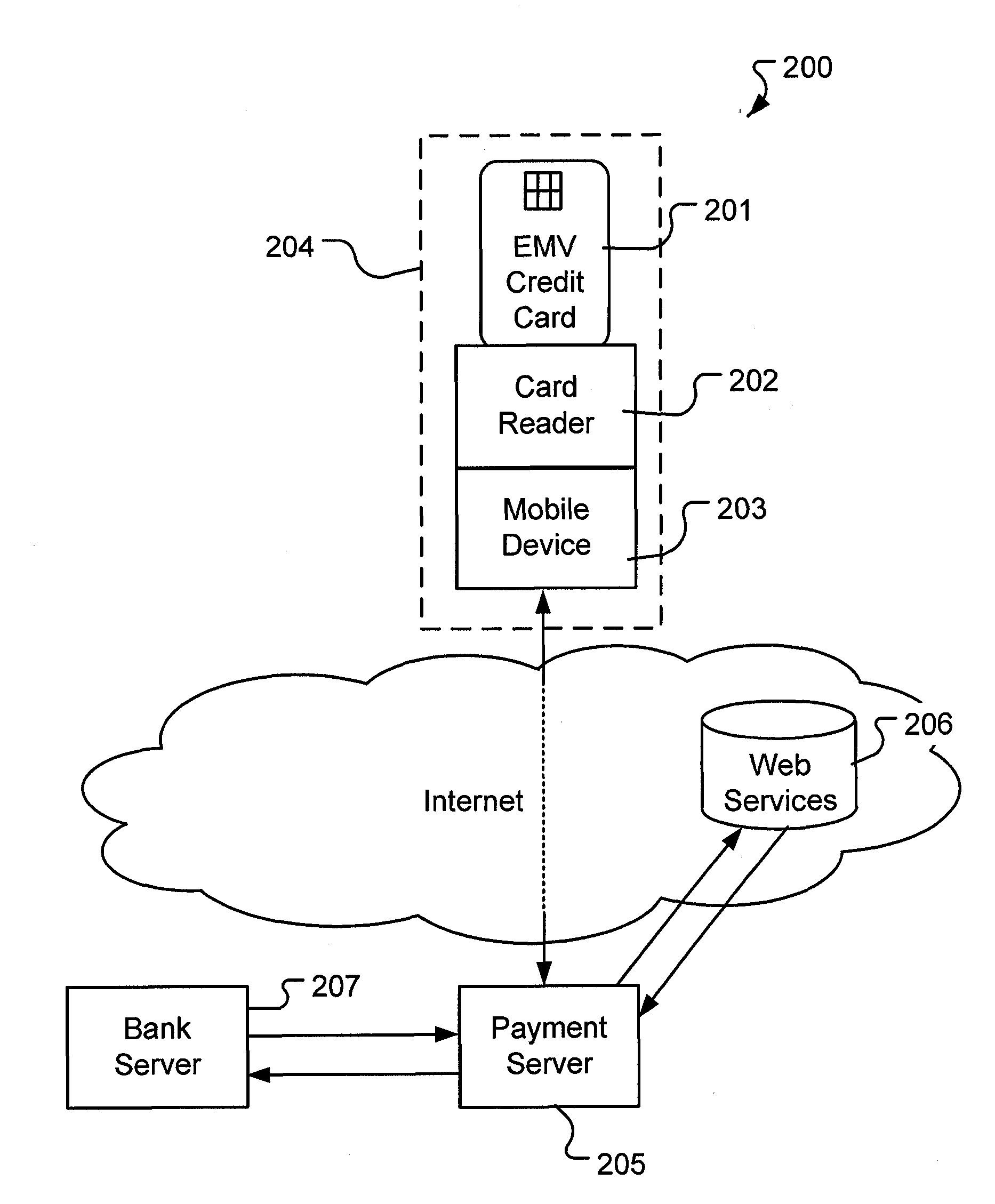

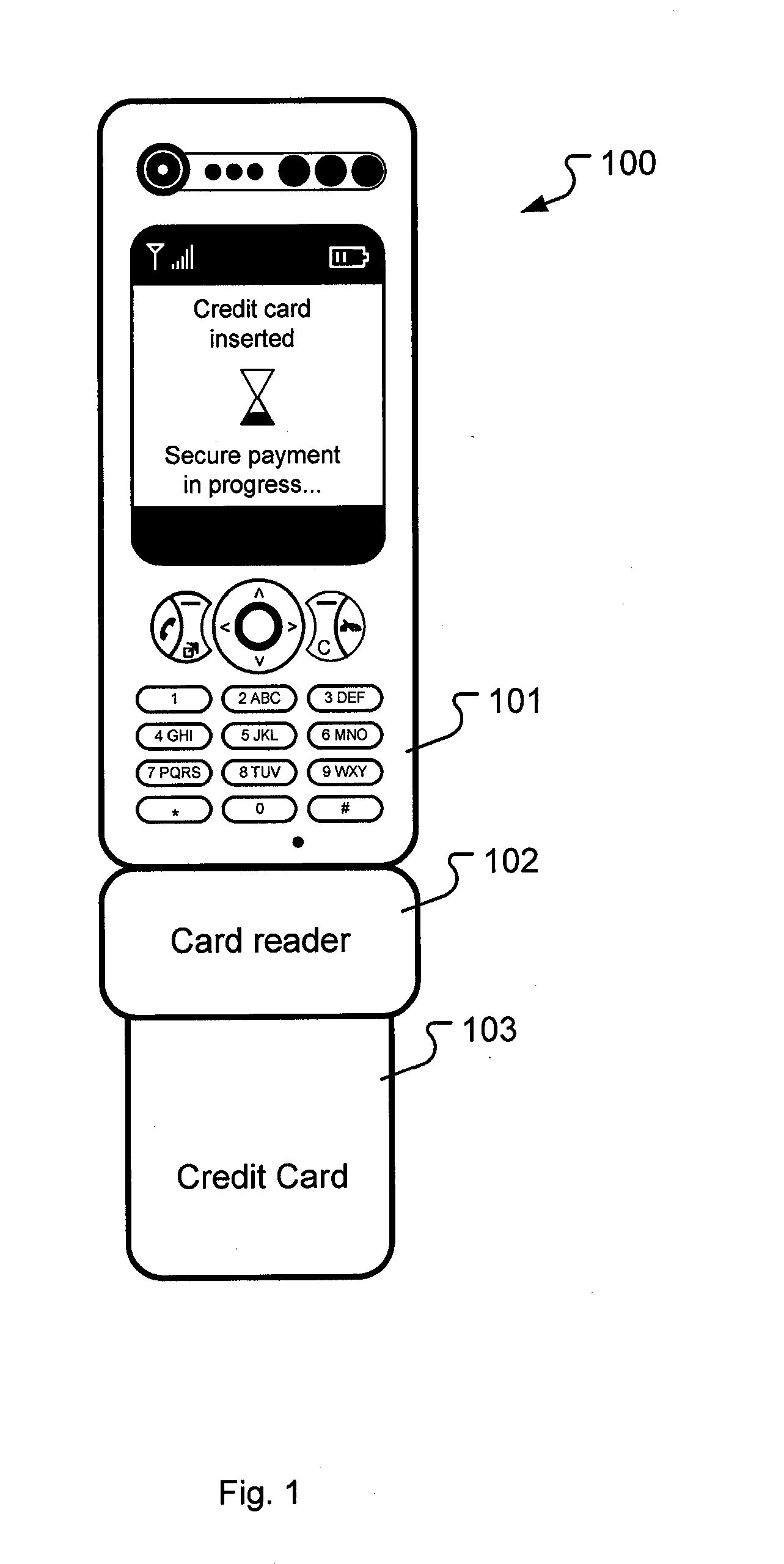

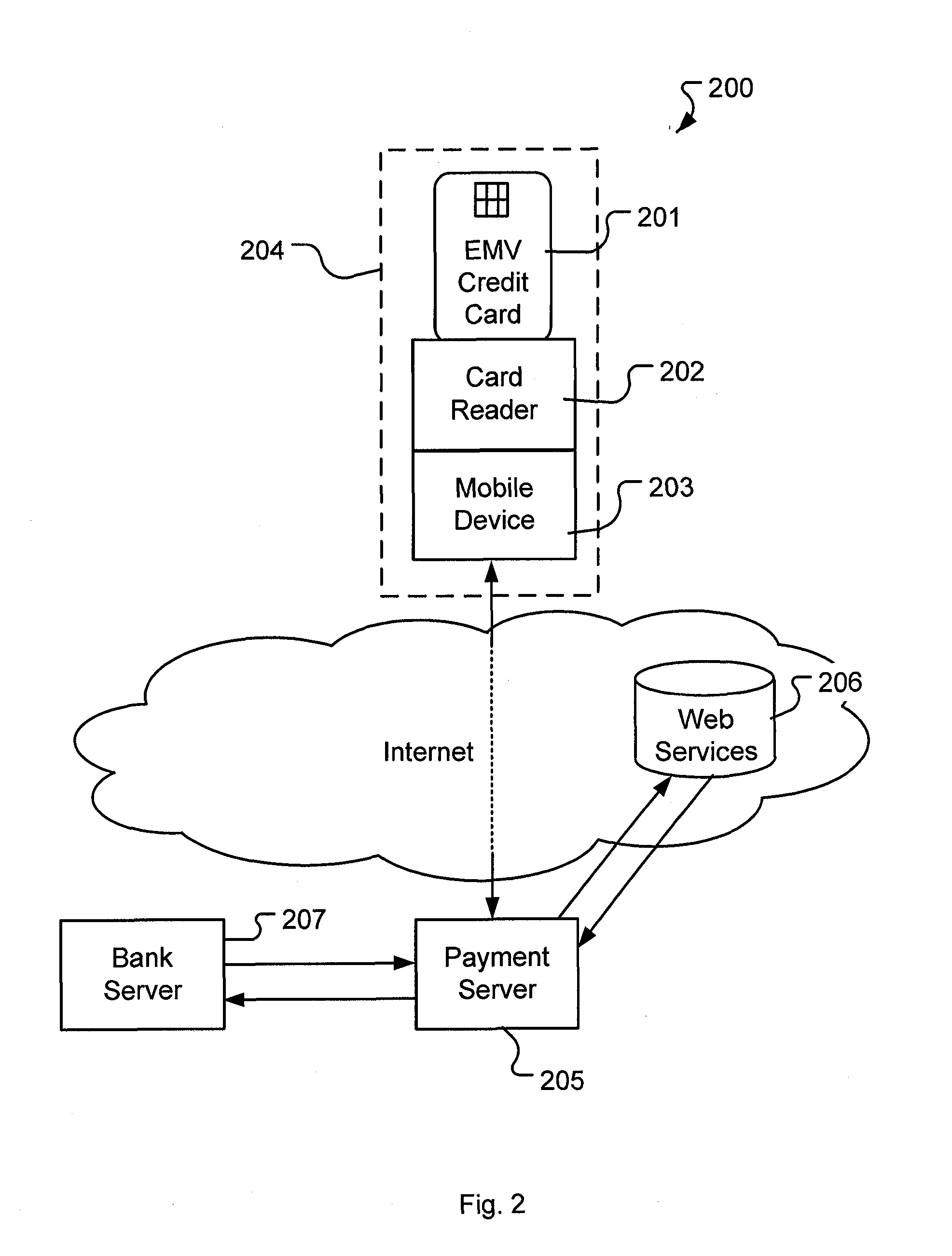

A method and system for verifying an identity of a card holder associated with a payment card using a payment device comprising a card reader and a mobile device. The method comprising the steps of initiating verification of identity of the card holder by inserting the payment card in the card reader of the payment device, reading card information from the payment card communicating the card information from the mobile device to a payment server, comparing received card information with stored card information in the payment server and accessing at least one web service. The account activity is analysed in the at least one web service and in that way verifying that the identity of the card holder is the same as the identity associated with the payment card, based on the analysis of information from the at least one web service and from the comparison of card information with stored card information. Terminating the verification process by communicating the result of the verification process from the payment server to the payment device.

Owner:IZETTLE MERCHANT SERVICES

Multi-account card with magnetic stripe data and electronic ink display being changeable to correspond to a selected account

A multifunction card includes a programmable memory, a magnetic stripe, and an electronic ink display. The programmable memory is able to store corresponding account data and image data for a plurality of different accounts. The card holder is able to use a portable terminal to select one of the accounts stored in memory. The terminal is able to write account data corresponding to the selected account to the magnetic stripe of the card. The terminal is also able to electronically change the electronic ink display to the image corresponding to the selected account. Thus, a single multifunction card, with the ability to have both its magnetic stripe data and appearance changed in accordance with a selected account, can substitute for many different cards.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

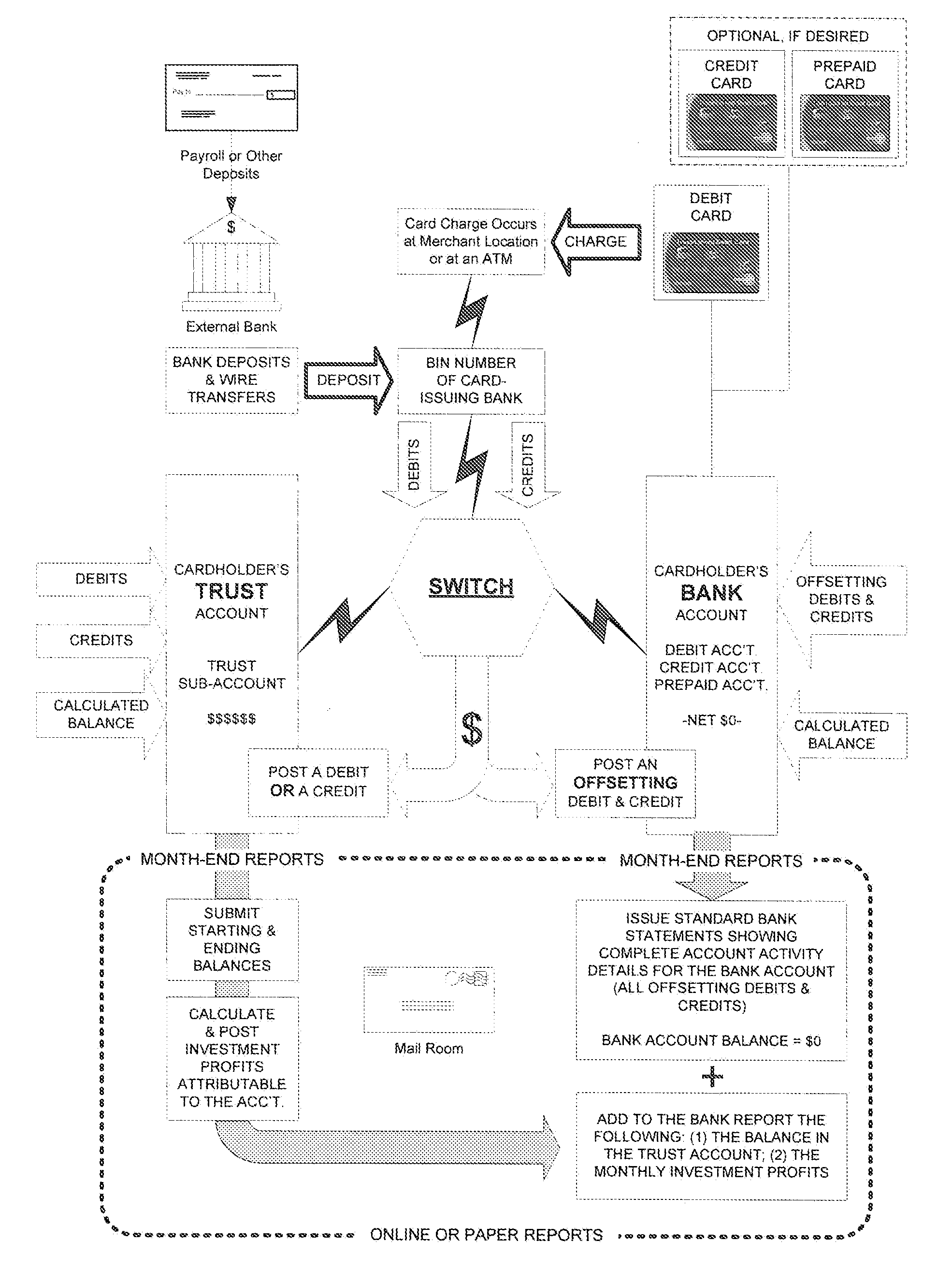

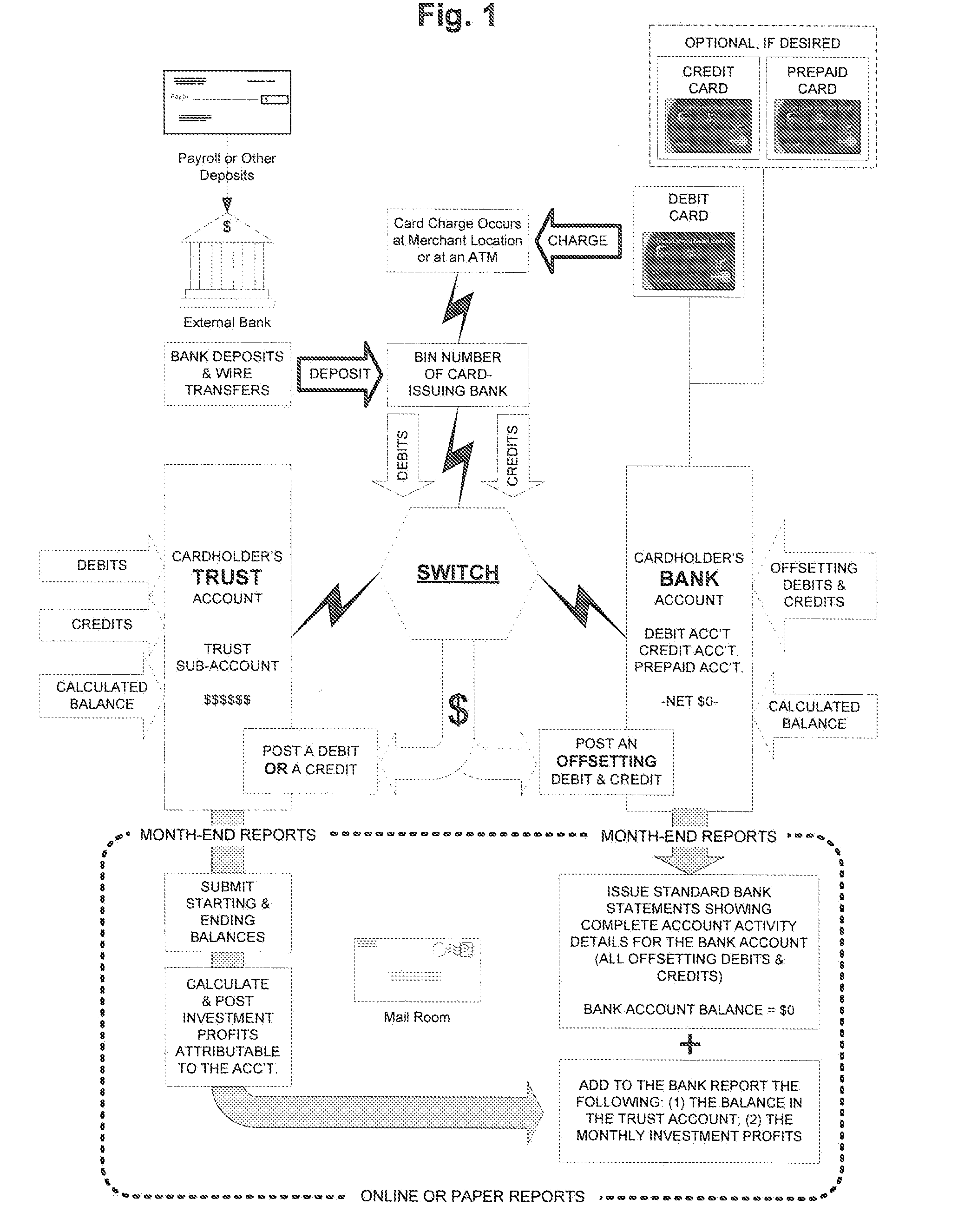

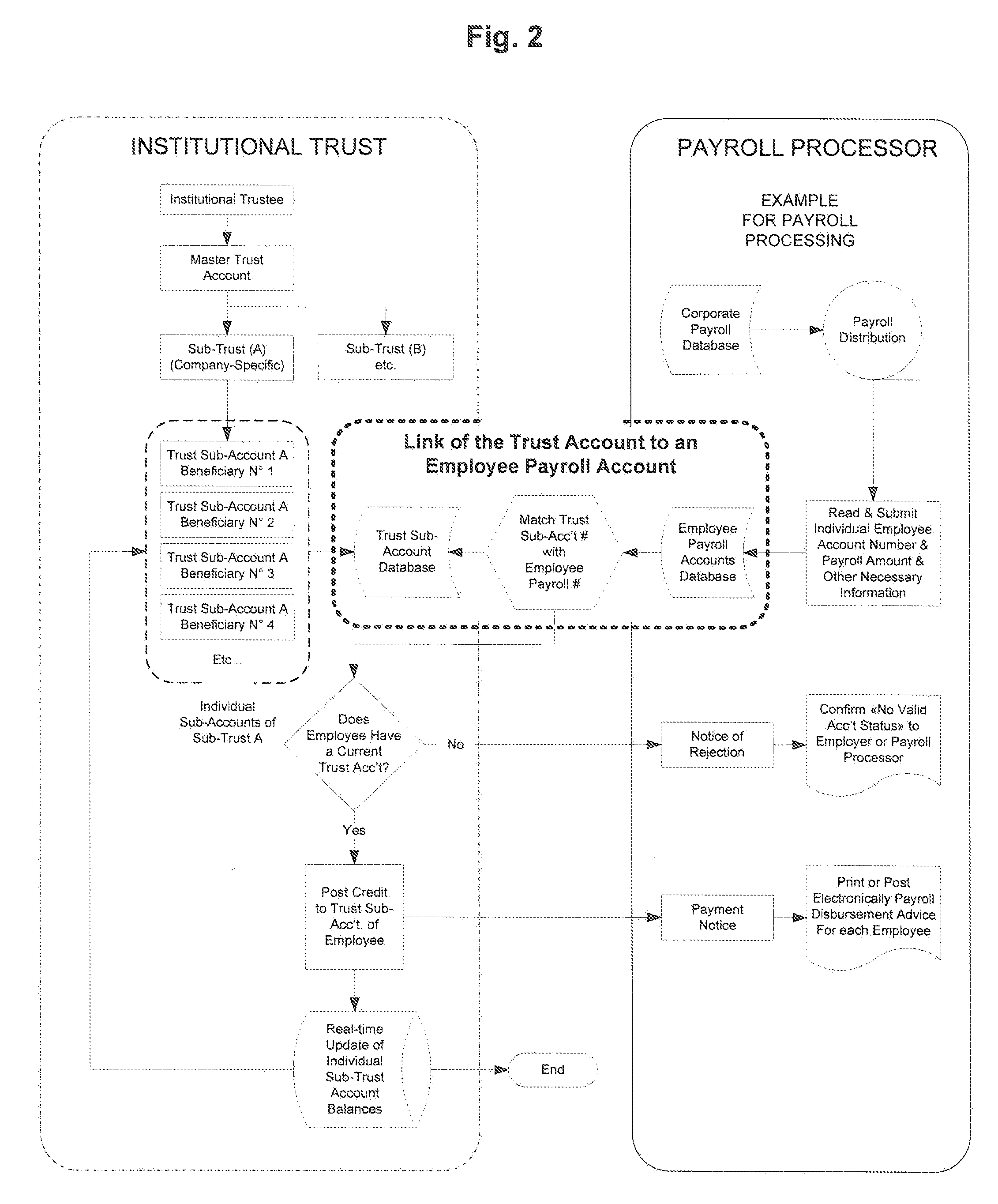

Revenue-producing bank card system & method providing the functionality & protection of trust-connected banking

A revenue-producing, charge card system also manages account balances to create an investment profit for the card holder. A trust account has a trust-account balance reflecting a first amount of funds, is constructed to subsequently record debits and credits related to the balance, and is constructed for access via remote communication. A bank account has a bank-account balance reflecting an initial zero balance, is constructed to further record debits and credits related to the balance, and is constructed for access via remote communication. A debit card is constructed for communication with the trust account and the bank account, and a switch is in communication with the trust account and bank account. The trust account and the bank account are constructed for intercommunication via the switch so that a card user can pass debits and credits to the trust account through the bank account so that the funds of the trust account can be managed via the trust account. There are also methods of producing revenue thorough a charge card, a revenue-producing machine for users who have bank accounts, and a revenue-producing, debit-card system for a user who has a bank account that is connected to a trust-like structure combined with a debit card connected to the trust-like structure. In addition, there is a controller, for a networked trust account and a networked bank account that are capable of communicating via a network, that maximizes revenue to the holder of both accounts, and a corresponding method. In addition, there is a principal-protected, revenue-producing investment system, an international financial system, and a method of providing an alternative international fiduciary financial system.

Owner:DE LA MOTTE ALAN L

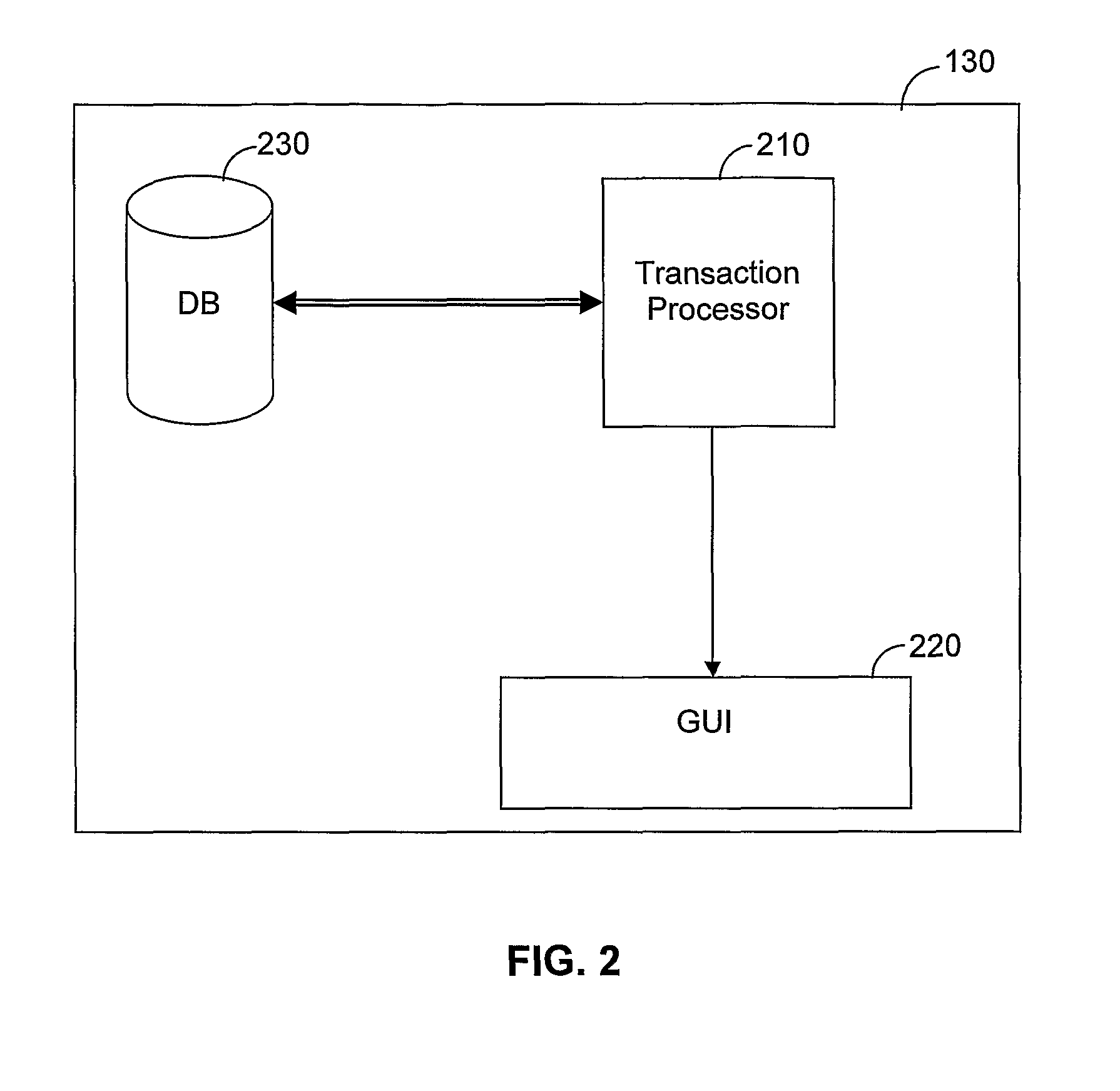

System, method and program product for account transaction validation

ActiveUS7347361B2Low costEasy to manufactureFinanceCredit schemesTransaction dataFinancial transaction

Owner:LOVETT ROBERT

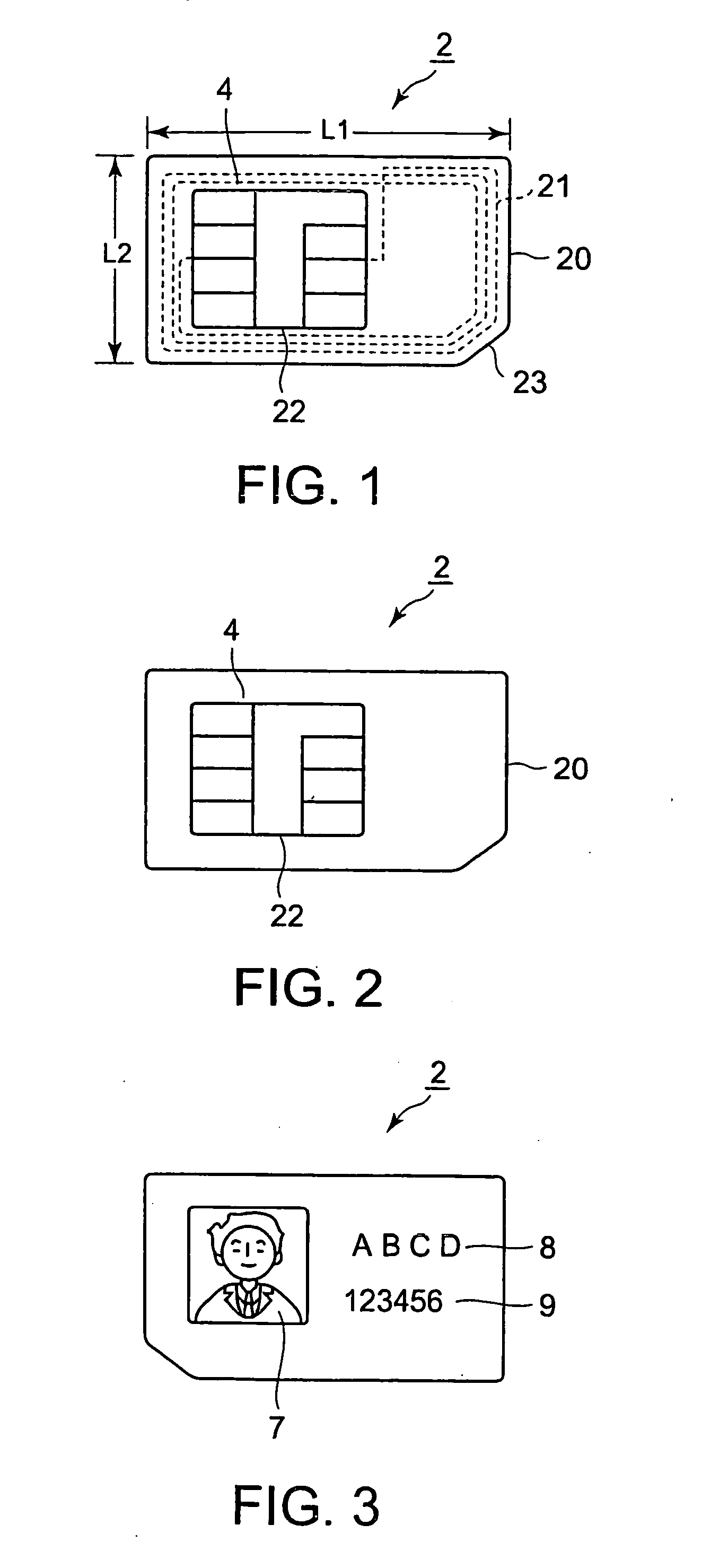

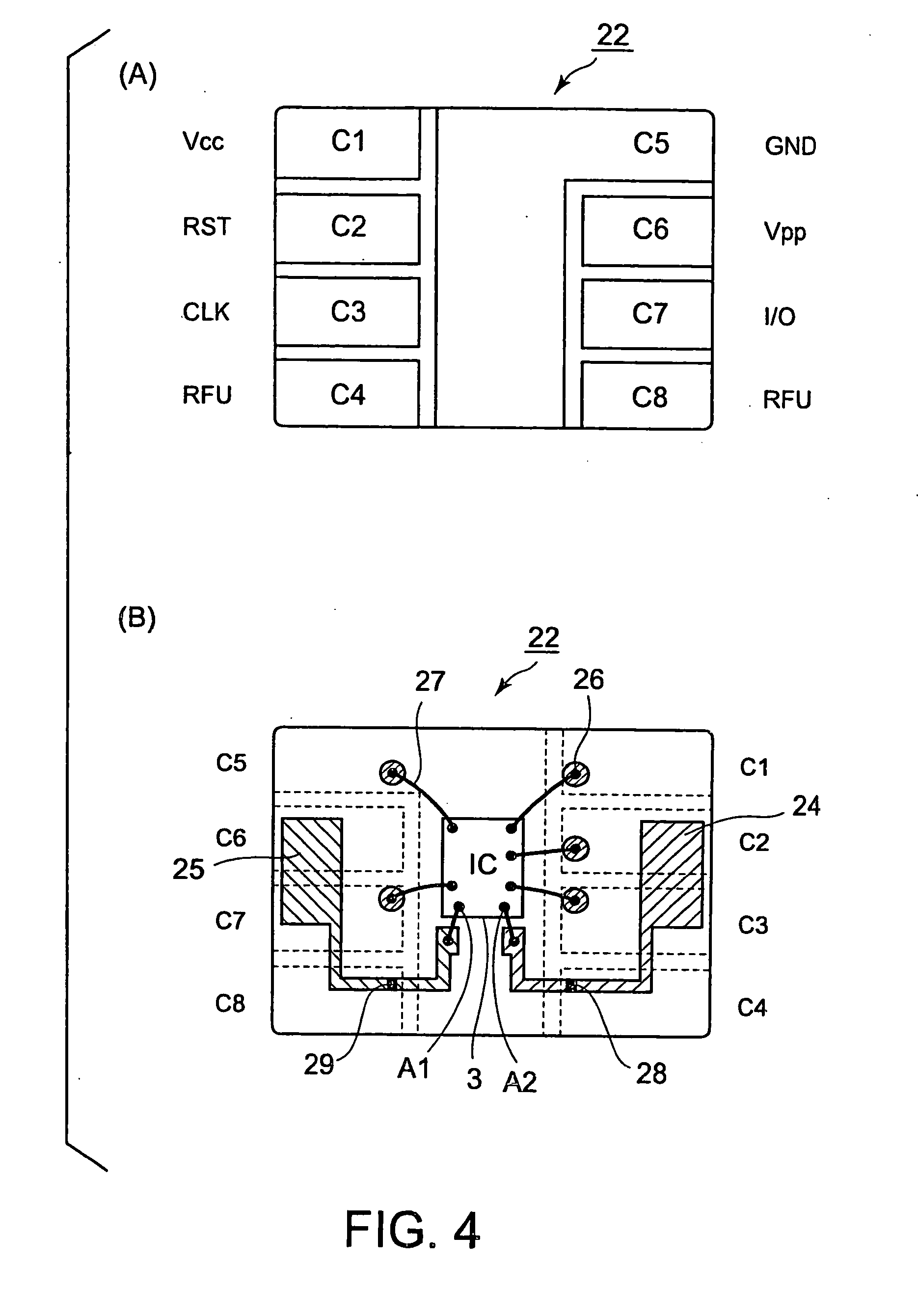

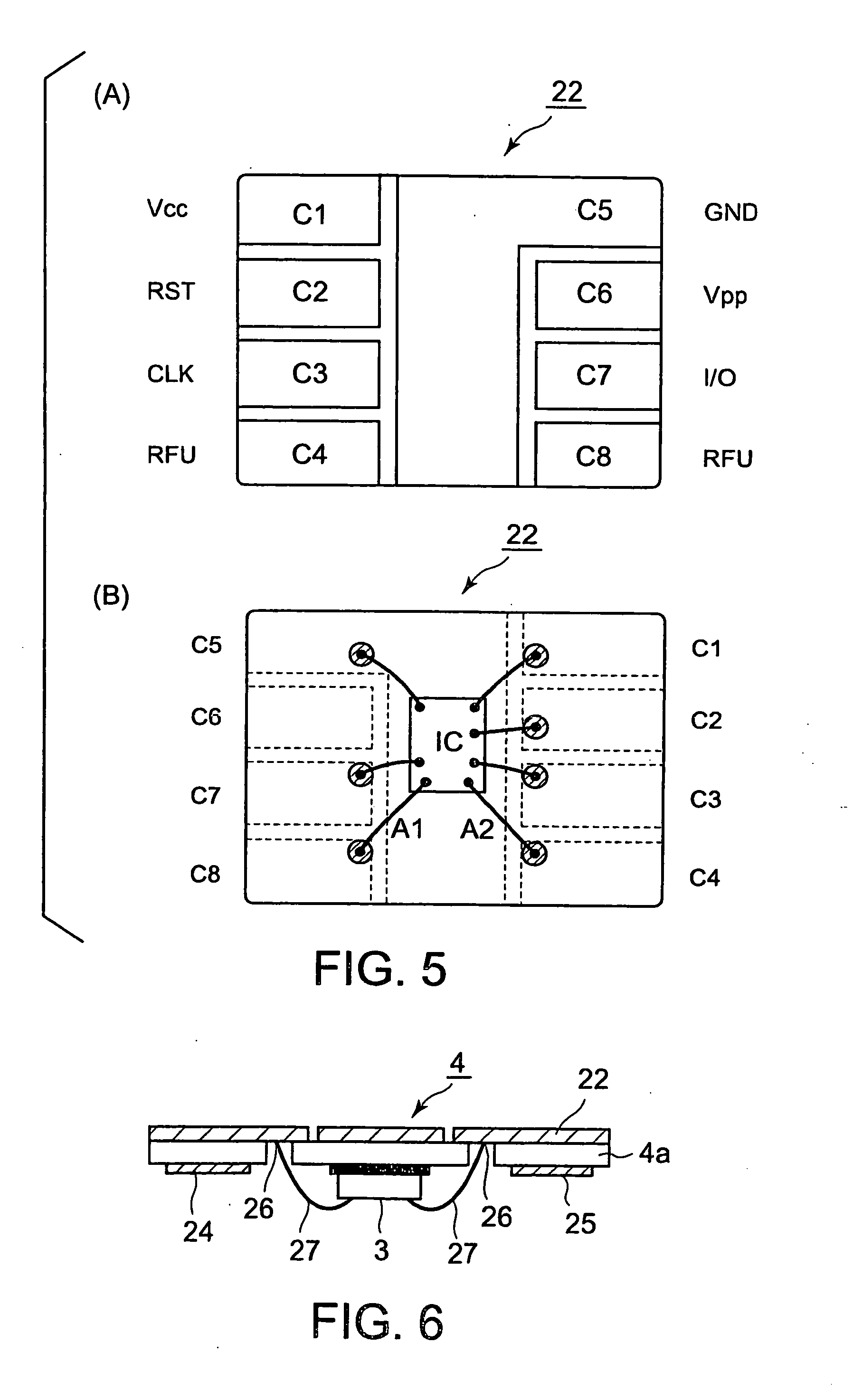

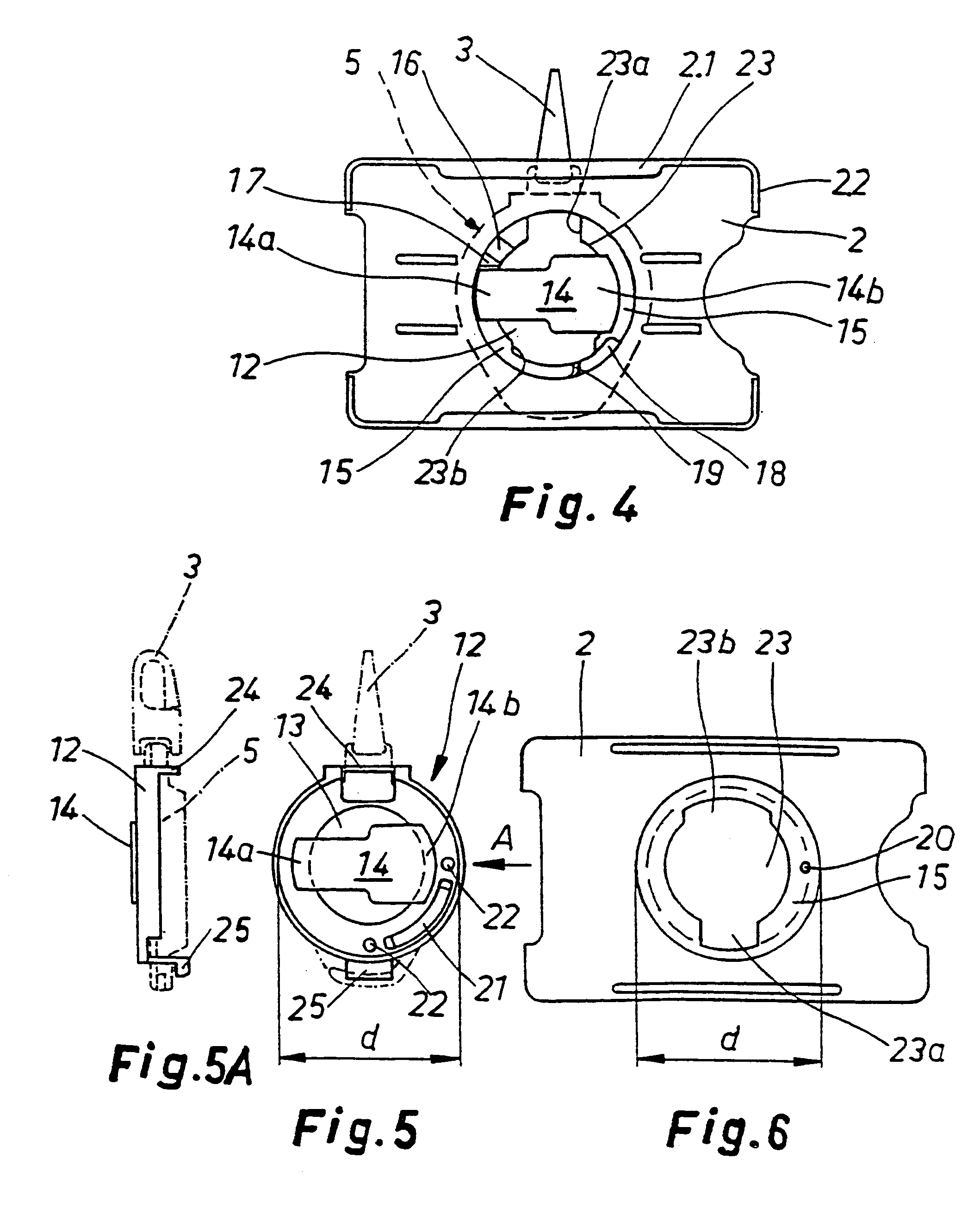

Sim, sim holder, ic module, ic card and ic card holder

InactiveUS20050212690A1Indication of parksing free spacesSolid-state devicesCard holderElectrical and Electronics engineering

Owner:DAI NIPPON PRINTING CO LTD

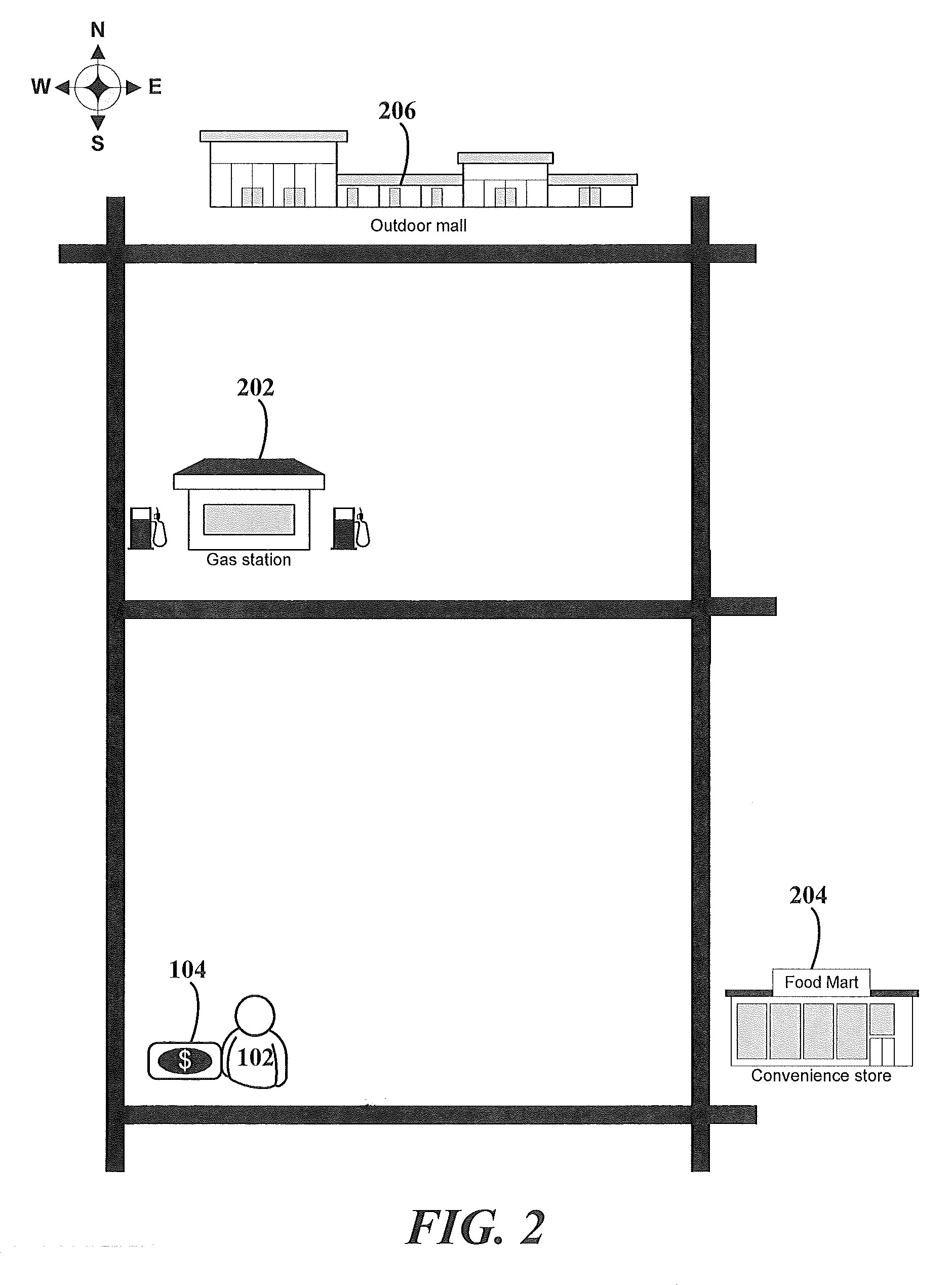

Method for authorizing the activation of a spending card

A method of authorizing the activation of a card holder's spending card is provided. The method includes receiving a request from the card holder to authorize the activation of the spending card and then requesting identity verification of the card holder. Following the identity verification request, the method includes obtaining a geographic location of the card holder. After determining the geographic location of the card holder, the method may include temporarily activating the deactivated spending card and instructing the card holder to conduct at least one transaction with the spending card at at least one selected location, wherein the selected location is selected based on the geographic location of the card holder. Spending card activity may be monitored to determine whether the at least one transaction was completed, and, based on whether the at least one transaction was completed, the activation of the spending card may be authorized.

Owner:PAYPAL INC

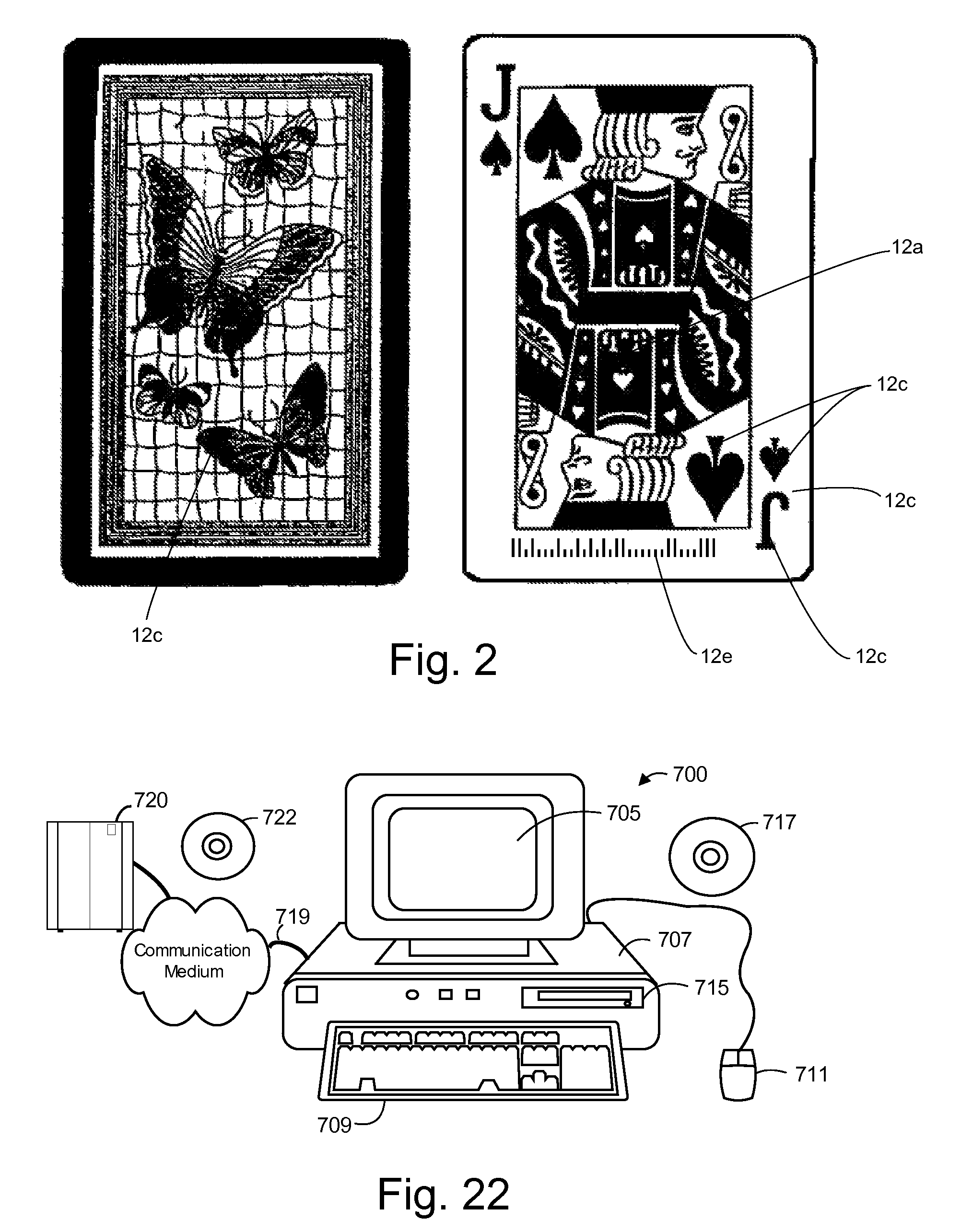

Method, apparatus and article for computational sequence generation and playing card distribution

A computationally generated playing card sequence (e.g., pseudo-random, non pseudo-random, or partially pseudo-random) allows shuffled distribution of playing cards. Playing cards may be organized into card holders by at least one or a rank and a suit, and retrieved in the computationally generated order. Alternatively, playing cards may be organized into card holders in order of a computationally generated sequence, and retrieve as necessary. Unreadable playing cards may be automatically removed from play.

Owner:BALLY GAMING INC +1

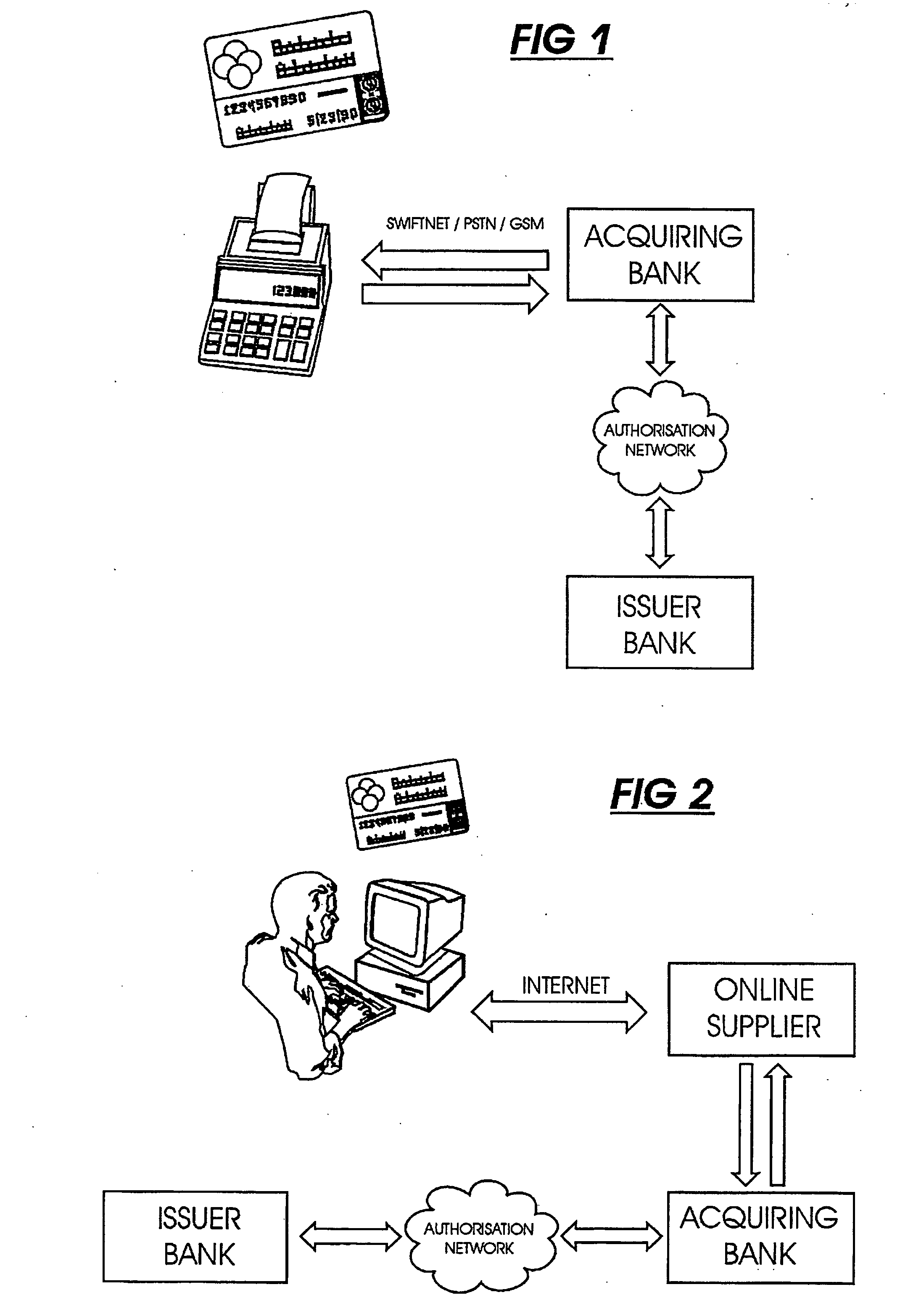

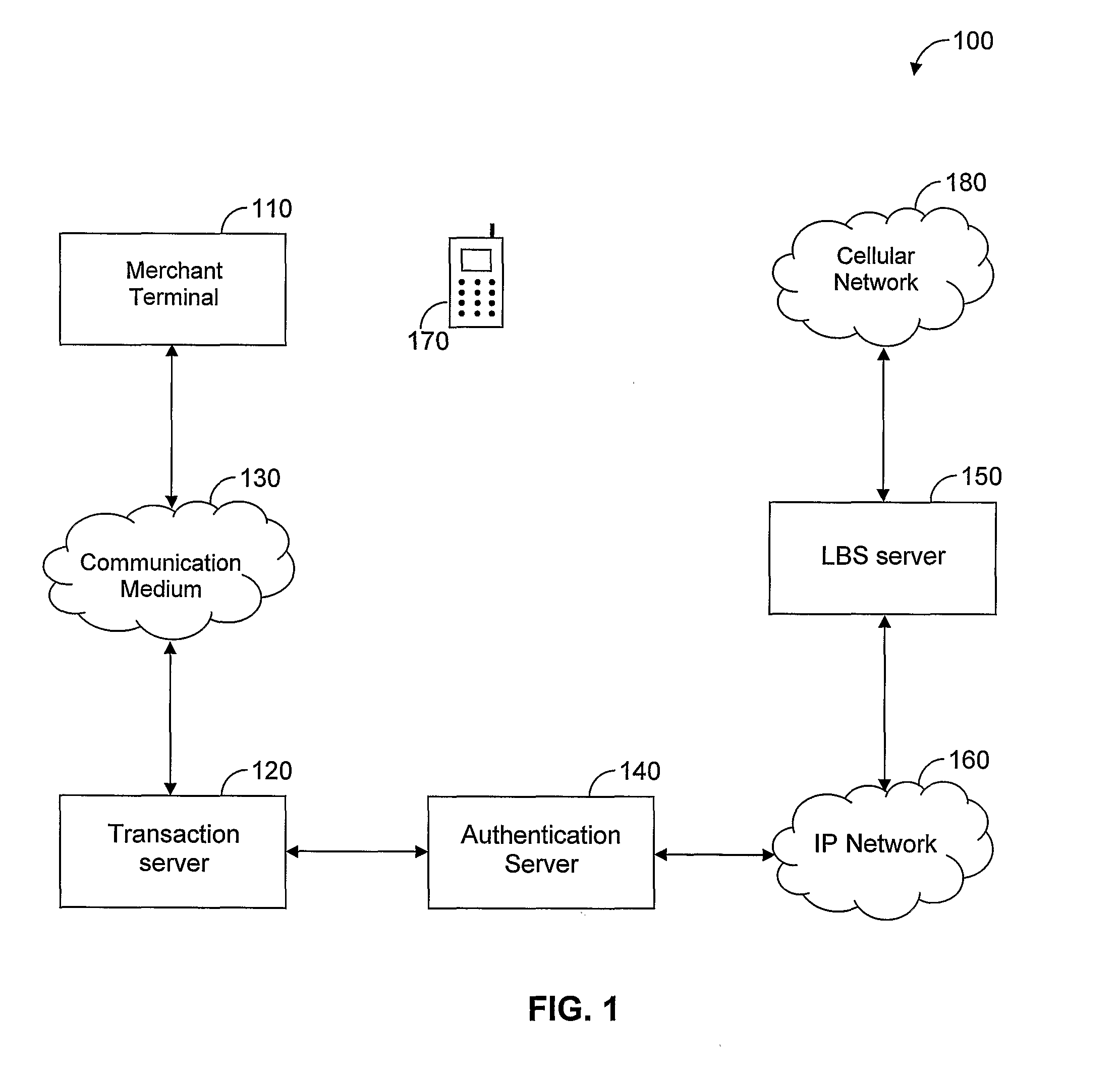

Transaction verification system

This invention uses separate, parallel communication channels to authorise and authenticate a transaction. A primary data channel (PSTN, radio or the like) is used to communicate between the merchant terminal and the bank, and a parallel data channel (a mobile phone network for instance) is used for the authentication process. In the example, the transaction is initiated (on a primary data channel), using a POS terminal as a transaction processing client. The transaction processing server and financial services provider fulfill their normal functions. At this point, the process loops into a transaction authorisation component using the parallel data channel, that requires authentication of the transaction initiator (the card holder). In the example, communications on the parallel data channel are by way of SMS. In the authorisation process, the card holder receives an SMS requesting authorisation of the transaction. If the card holder is not the transaction initiator, the card holder can cancel the transaction. If the transaction can be authorised, an authentication process is initiated in which the mobile phone is programmed to require the entry of a normally secret code (such as a personal identification number (PIN)) that serves to authenticate the card holder and to give final authorisation of the transaction.

Owner:NARAINSAMY SELVANATHAN

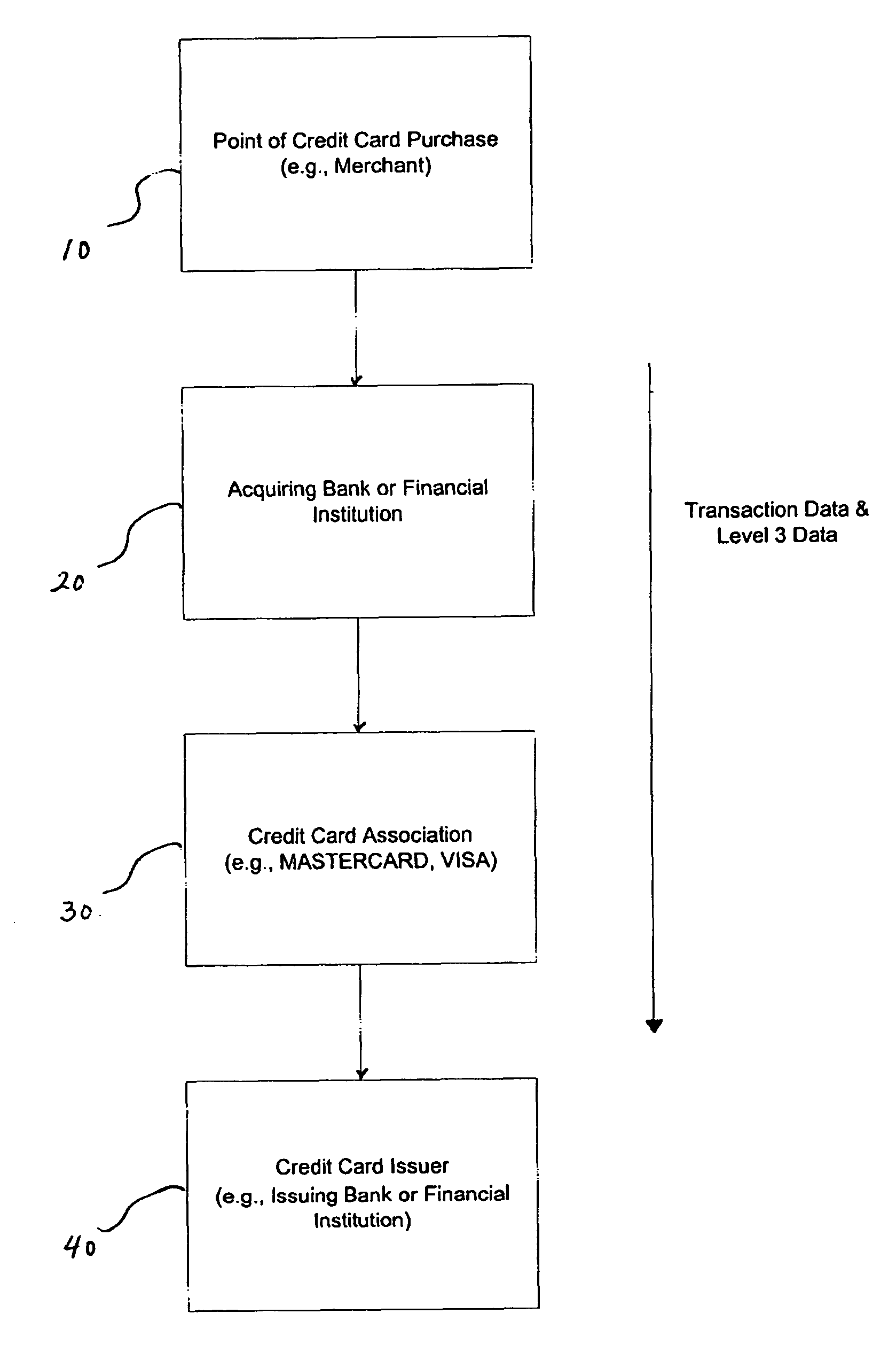

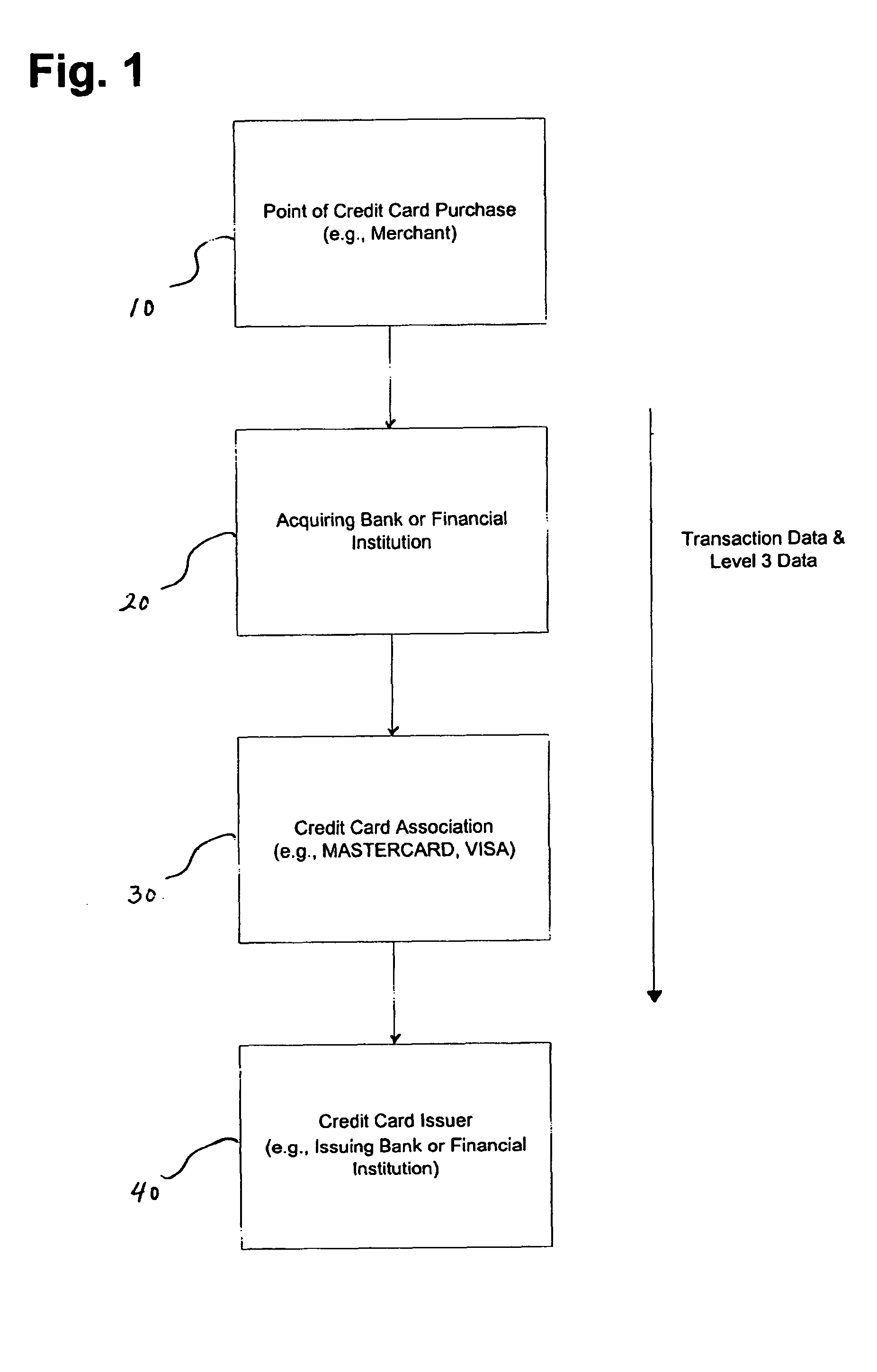

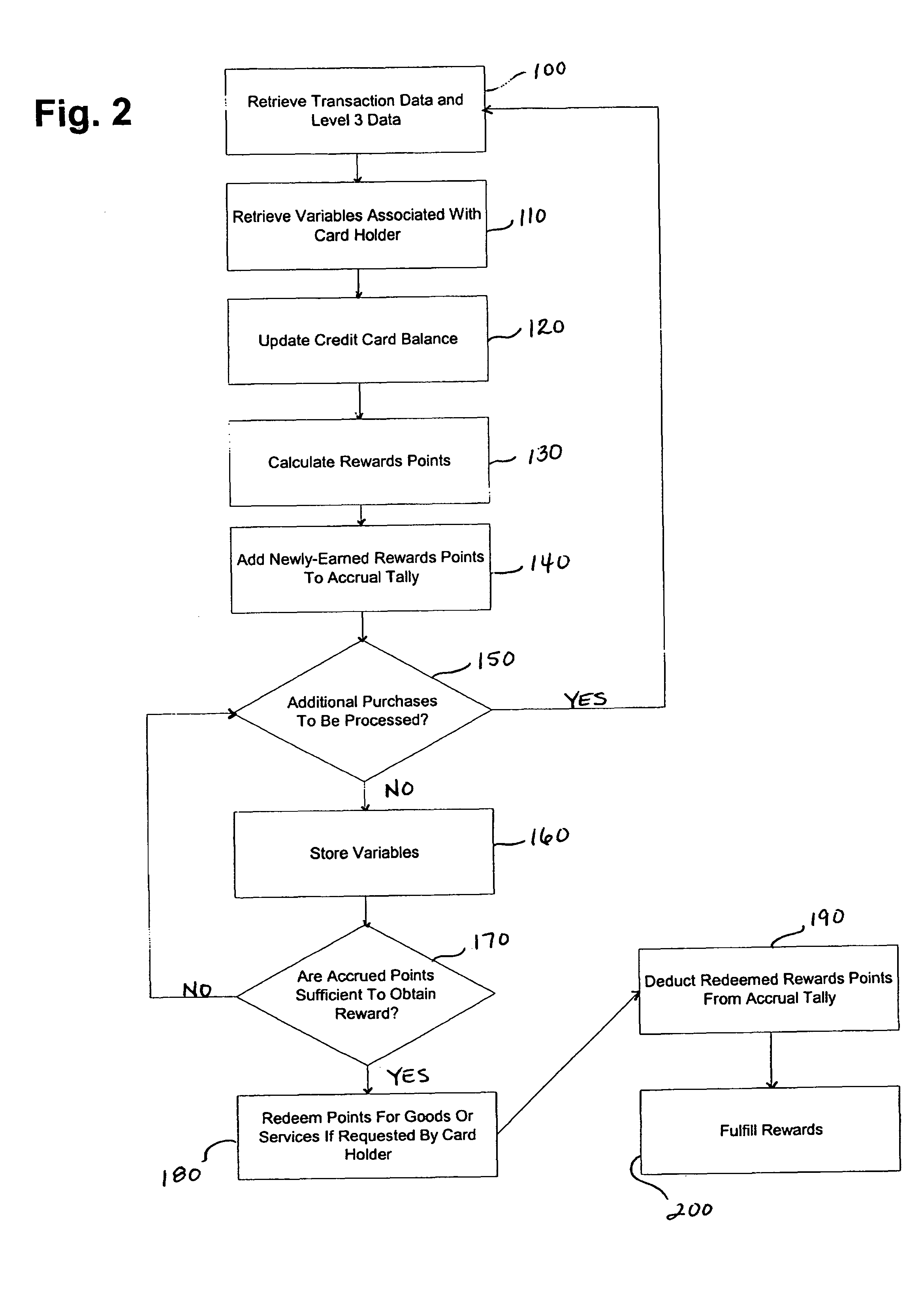

Credit card rewards program system and method

ActiveUS7949559B2Improve creditEasy to useTicket-issuing apparatusCredit schemesCredit cardProgram planning

A platform and program for enhancing the value and desirability of a credit card (or other payment product) to a card holder and encouraging increased use of the card as a payment device by rewarding the card holder based not only on qualifying purchases but on miles traveled in connection with travel ticket or travel pass purchases. The inventive program leverages qualifying transaction information and other data (e.g., Level 3 Data) which automatically flow with such transaction information. The rewards redeemed by the card holder according to the inventive platform and program are not tied to a particular provider of goods or services, and reward fulfillment is managed through the card issuer or its fulfillment agent.

Owner:CITICORP CREDIT SERVICES INC (USA)

Table with sensors and smart card holder for automated gaming system and gaming cards

InactiveUS8221244B2Low costMore secure and reliable gaming experienceCard gamesApparatus for meter-controlled dispensingPlaying cardHand held

Methods and systems are disclosed for intelligent tracking and / or play and / or management of card gaming use an intelligent card distribution or holding device with detectors for determining the value and unique identity of individual cards and for recording card play. Playing cards are equipped with a read / write data storage connected to a transponder and / or incorporated into electromagnetic writable particles or smart particles (smart dust). A system of the invention records various game play events on the playing cards themselves during game play and optionally also in a database on the system. In specific embodiments, the principal scanning and writing elements and electronic and optical interfaces are embodied into a hand-held card holder (HHCH). The system can scan playing cards, scan gaming chips, indicate a player's win / loss / draw, increase or decrease player betting positions, and compute awards to players based on their playing activity.

Owner:FRENCH JOHN B

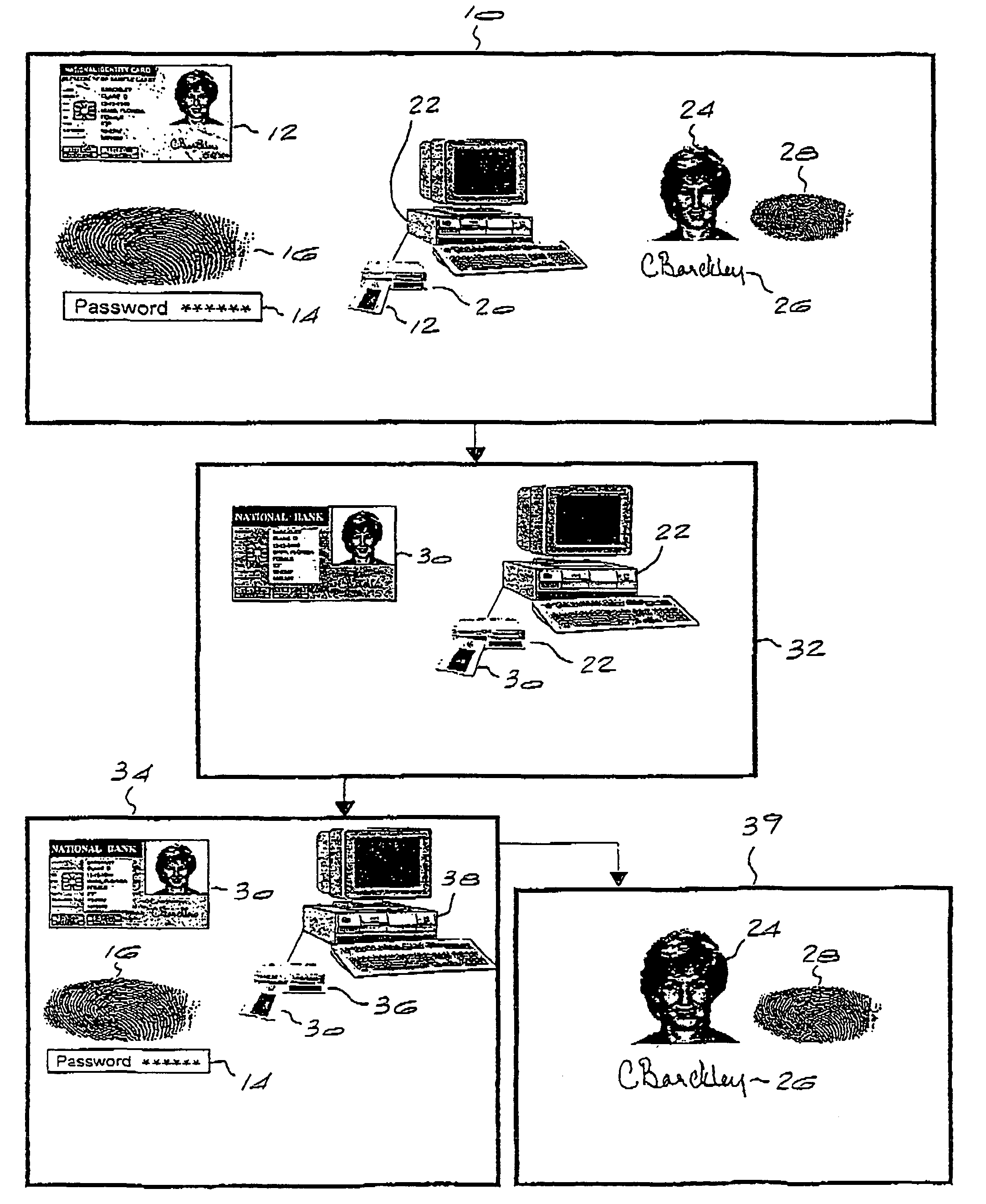

Transfer of verification data

InactiveUS7789302B2Payment architectureCoded identity card or credit card actuationSmart cardCard holder

A method and system are provided for transferring verification data from a first carrier to at least a second carrier in a secure manner. A first carrier, which is typically a smart card based ID card, contains verification data to identify the card holder securely. The method of the invention verifies the verification data on the ID smart card, reads the verification data, compresses and encrypts it, and writes it onto a second carrier, which may be a second smart card or a printed document, for example, in a machine readable form. The invention permits verification data to be securely transferred from one carrier to another, which permits a high degree of security in numerous applications such as the issuing of bank cards, medical aid claims, and other valuable documents.

Owner:DEXRAD

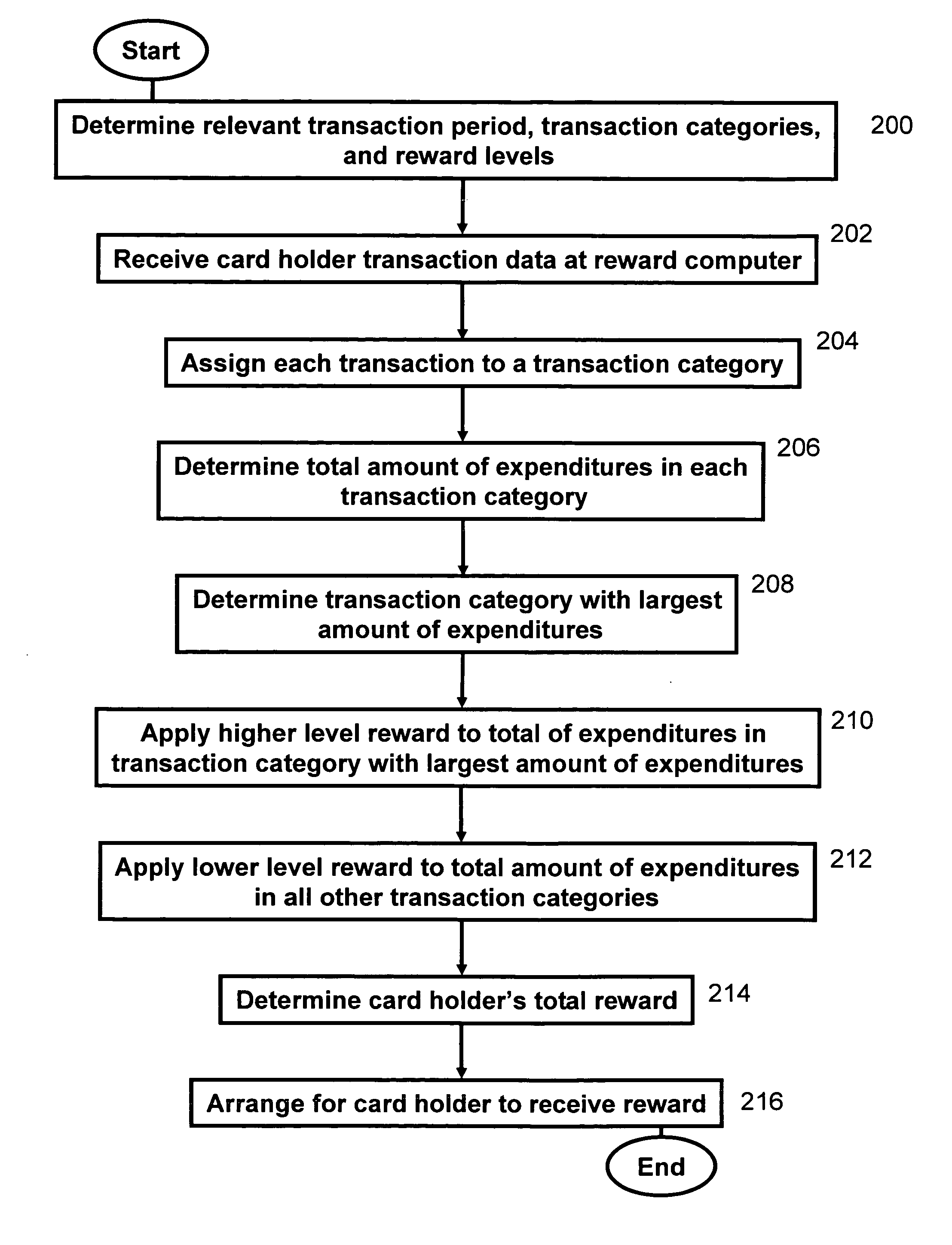

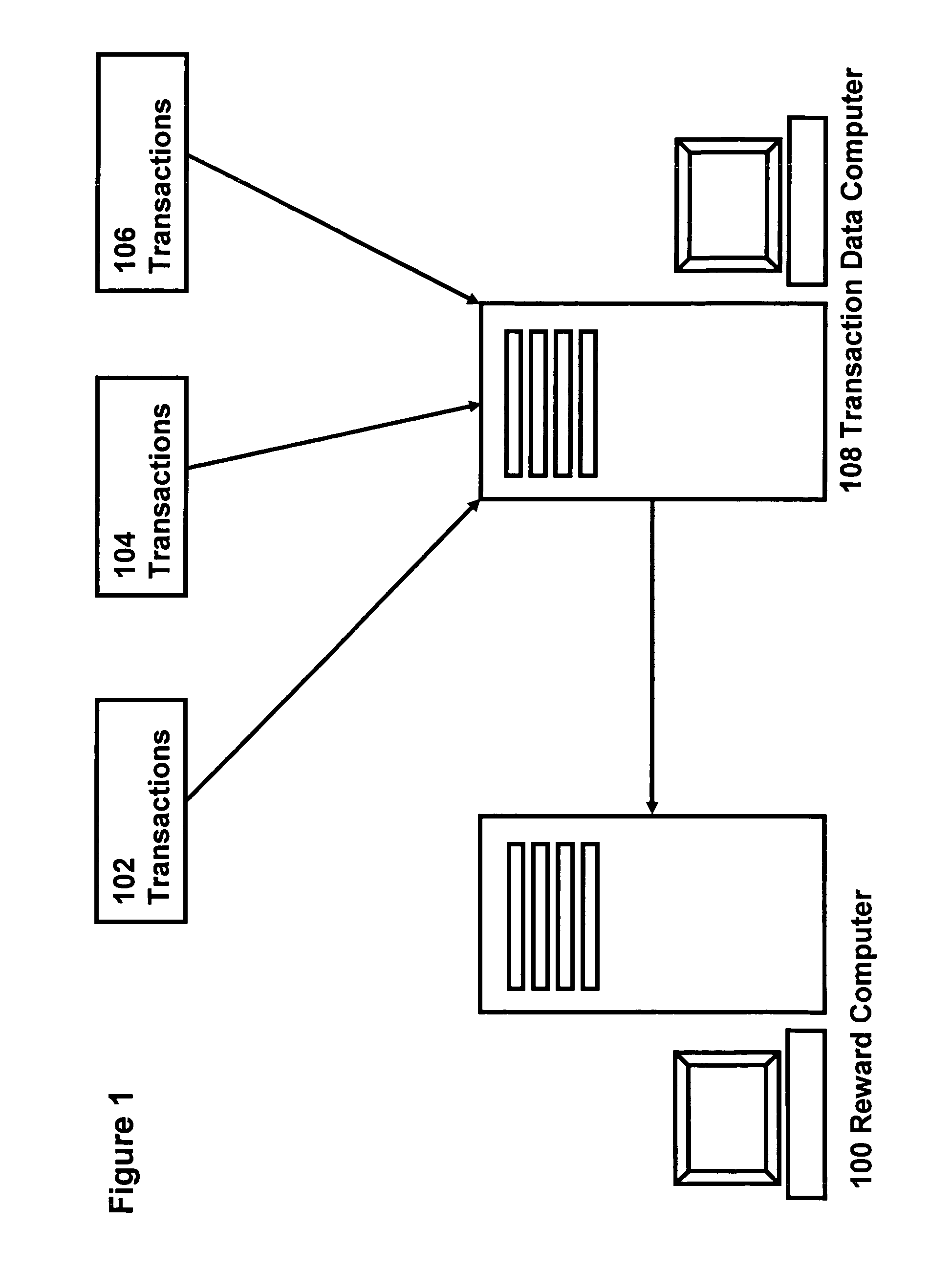

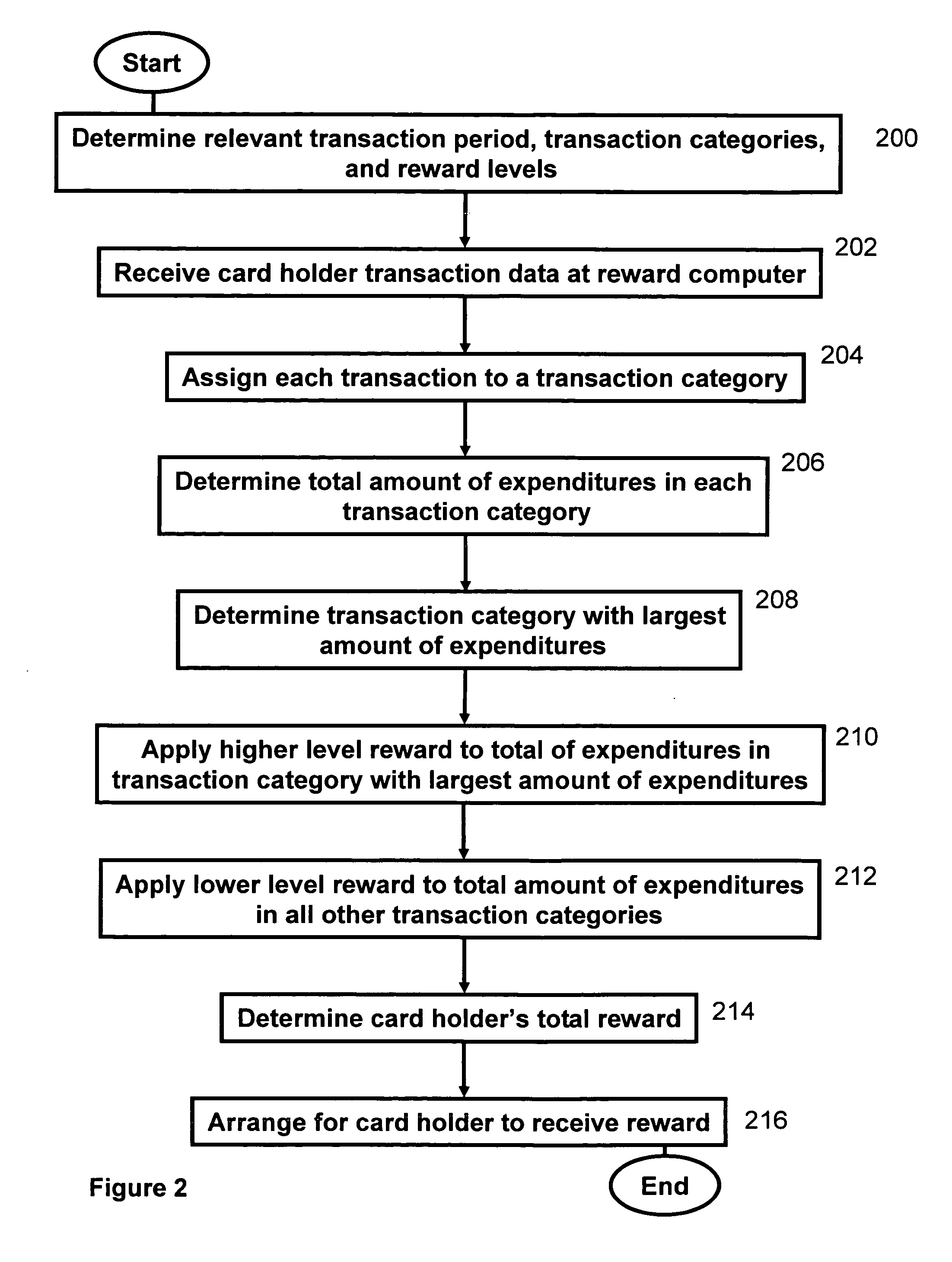

System and method for issuing rewards to card holders

A system and method for issuing variable level rewards to card holders according to expenditures in transaction categories. Card transactions for a specified period of time are classified by codes and are assigned to one of several transaction categories such as entertainment, travel, dining, sporting goods, and electronics. A total amount of expenditures for each transaction category is determined. The transaction category with the largest value of expenditures is determined. The highest available reward is applied to the total amount of expenditures in the transaction category that has the largest value of expenditures. Consumers may take advantage of a high level or more valuable reward in a multi-level reward structure regardless of their spending habits or patterns because the more valuable reward is applied to the expenditures in the largest expenditure transaction category.

Owner:RBS NB

Method, apparatus and article for computational sequence generation and playing card distribution

A computationally generated playing card sequence (e.g., pseudo-random, non pseudo-random, or partially pseudo-random) allows shuffled distribution of playing cards. Playing cards may be organized into card holders by at least one or a rank and a suit, and retrieved in the computationally generated order. Alternatively, playing cards may be organized into card holders in order of a computationally generated sequence, and retrieve as necessary. Unreadable playing cards may be automatically removed from play.

Owner:BALLY GAMING INC +1

Debit card system loan provisions

Debit card systems having loan provisions, and methods of use. Such systems couple a debit card to a financial account having access to the national eft system. The debit card system satisfies the requirements of TISA Regulation DD. Debit card accounts of the invention enable the card holder to access proceeds of short-term loans using the debit card. When coupled with deposit of the card holder's payroll into the card account, by the card holder's employer, such short-term loans are automatically repaid when the employer makes a payroll deposit. Card systems of the invention satisfy the notice provisions of TISA regulation DD by funding the debit card account with loan proceeds only after the card holder has received notification of the conditions, fees, and other costs, and releasing such funds for withdrawal through e.g. an ATM only pursuant to requests therefore received after the card holder has approved such conditions, fees, and other costs.

Owner:G & T MANAGEMENT

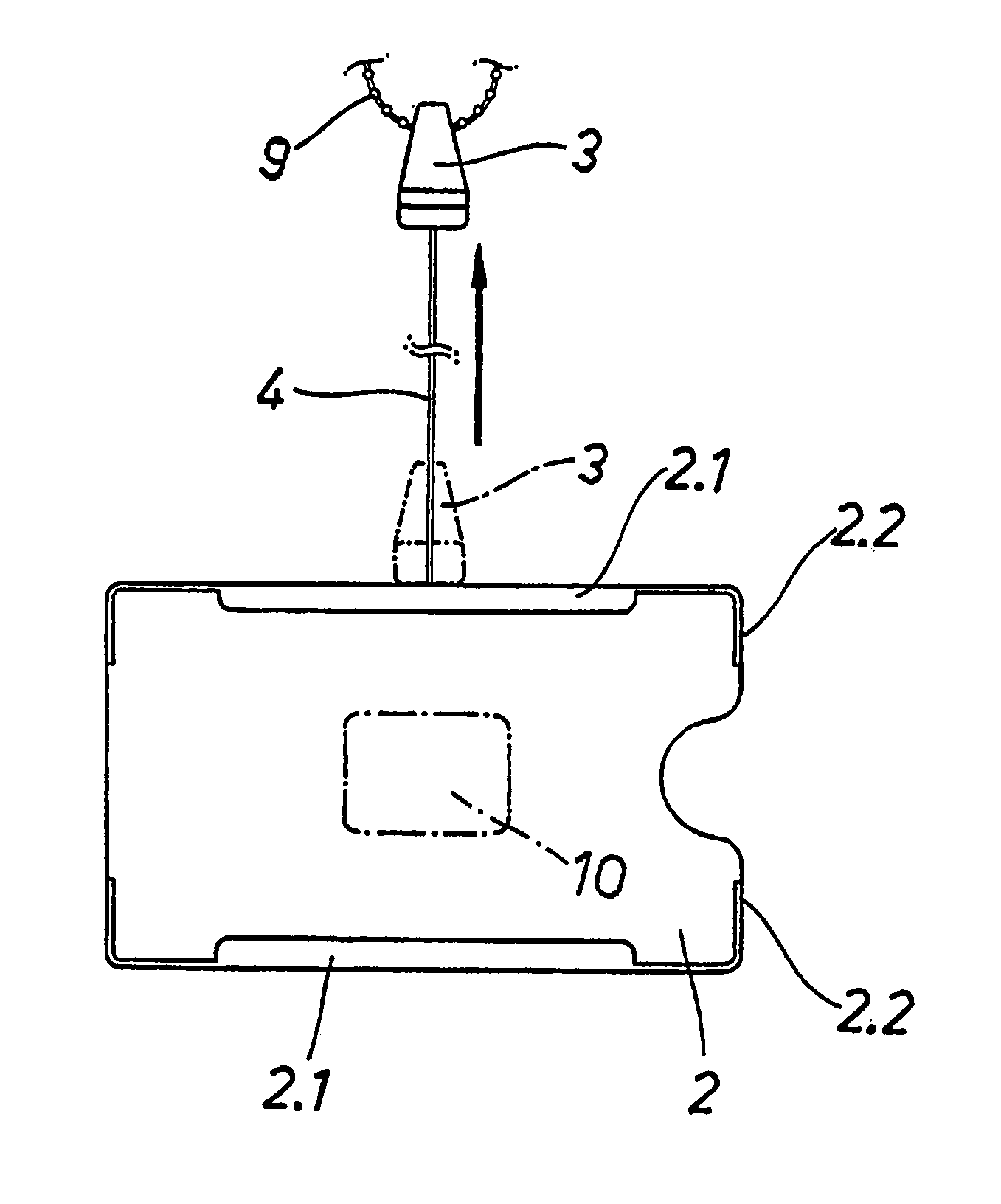

Holder for an identification card

An identification card holder, on the front side of which a replaceable identification card can be placed. A spring-loaded yo-yo is fastened and positioned on the reverse side of the holder, such that the yo-yo remains partially or completely invisible as the card, along with its holder, is viewed from the front side. As the yo-yo is integrated with the holder, the result will be a small-sized, readily portable, and easy-to-handle assembly, which can be distanced from a bearer to the proximity of a code reader for an electric lock without releasing the suspension.

Owner:MEGALOCK

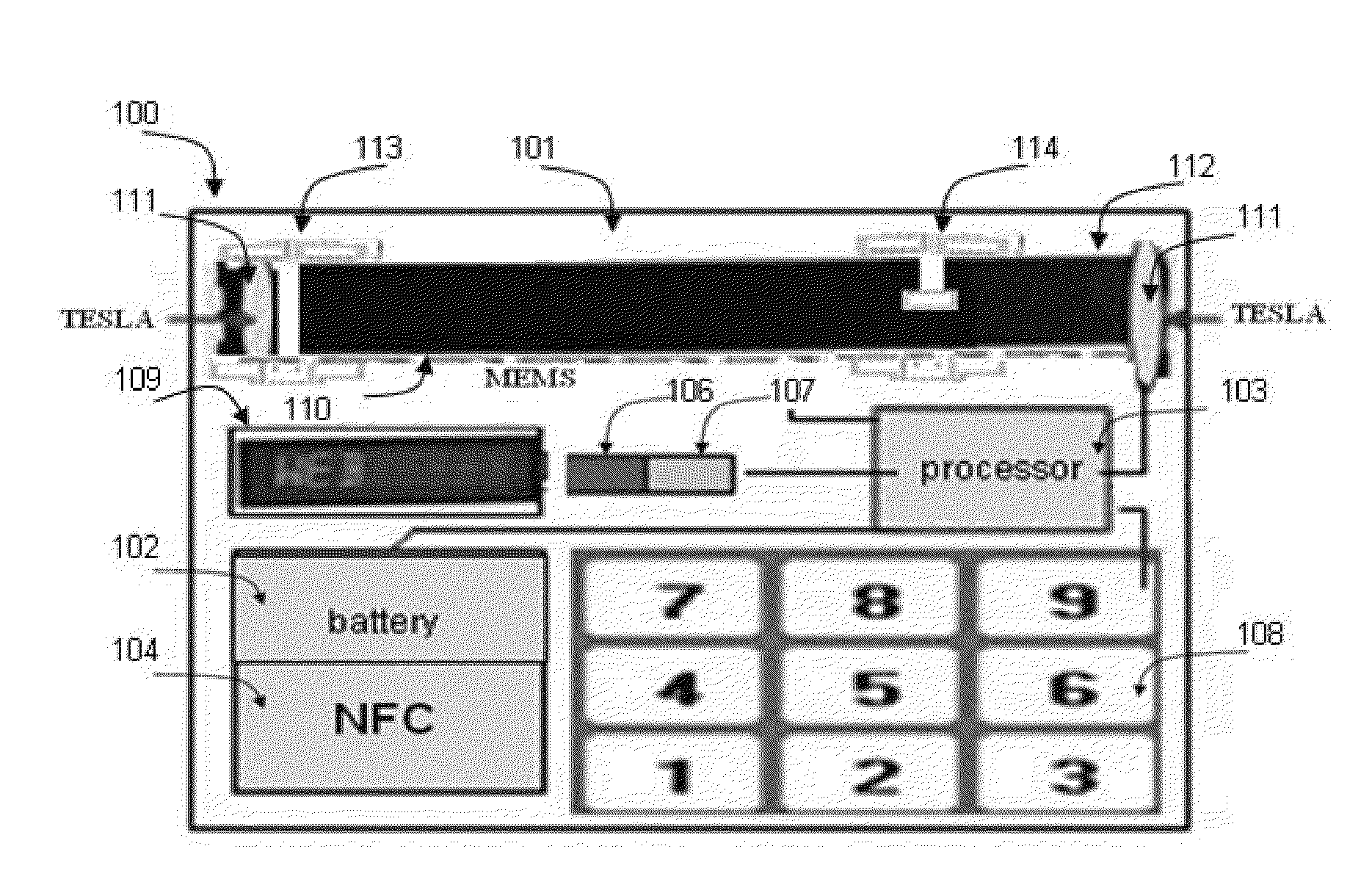

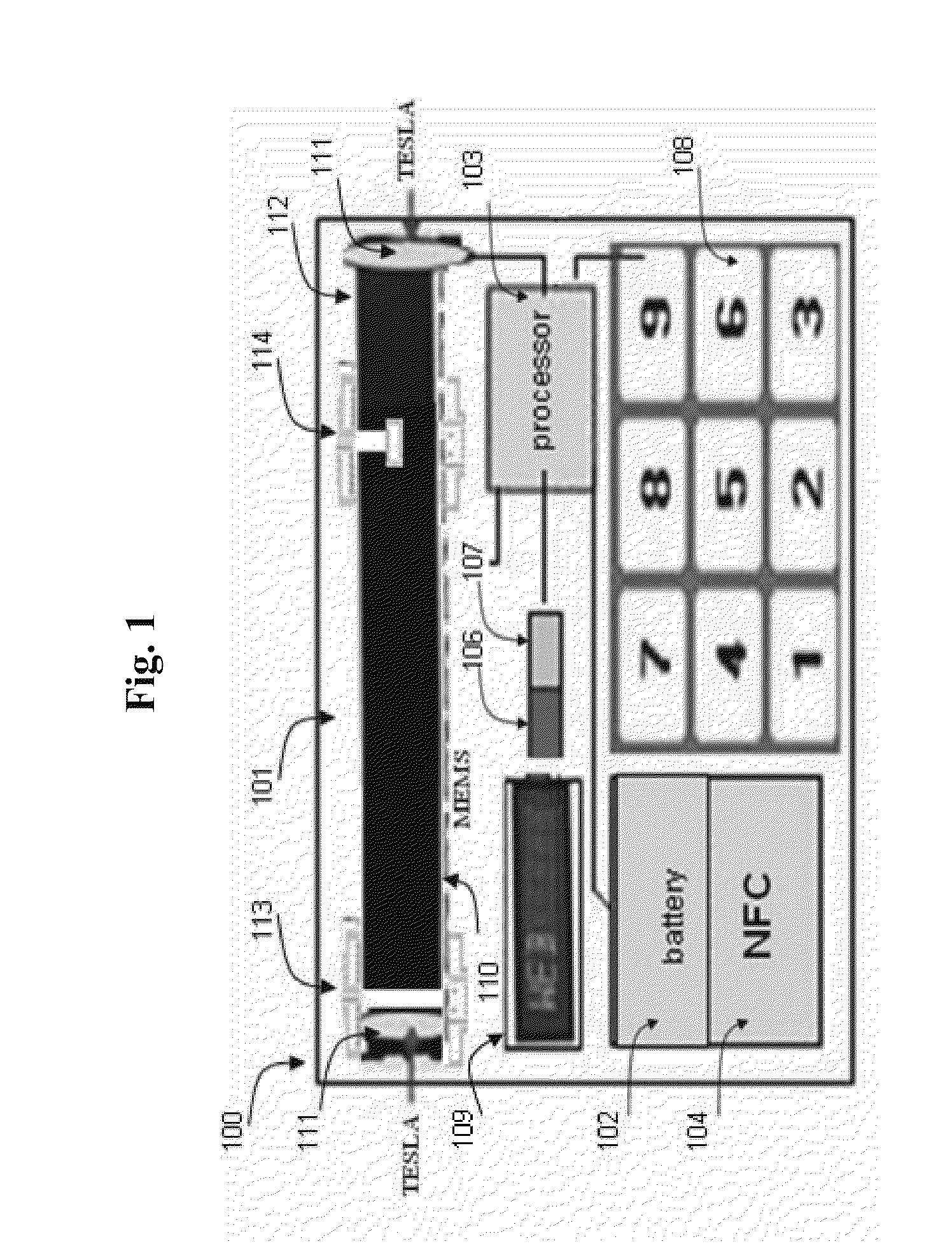

Transaction Card With Improved Security Features

ActiveUS20110174874A1Communication is disconnectedComplete banking machinesFinanceCard holderNormal state

A transaction card with improved security features, comprising: an authentication unit and a magnetic stripe wherein parts of the magnetic field pattern of said magnetic stripe are generated by currents running through coils only after the authentication unit authenticates the transaction card holder. One or more sensors detect attempts to read the card by two magnetic heads, and block the card if a cloning attempt is suspected. The transaction card is thus closed for transactions in a normal state, and the magnetic information is not readable. Only after the card holder authentication, then currents are run through the coils to generate the magnetic information and make the magnetic stripe readable by commercial devices. Authentication means may include entering a PIN via a keyboard, entering a PIN via a keypad, voice recognition identification of one or more voices, biometric identification, or identification via a connection to a remote device.

Owner:POZNANSKY AMIR +2

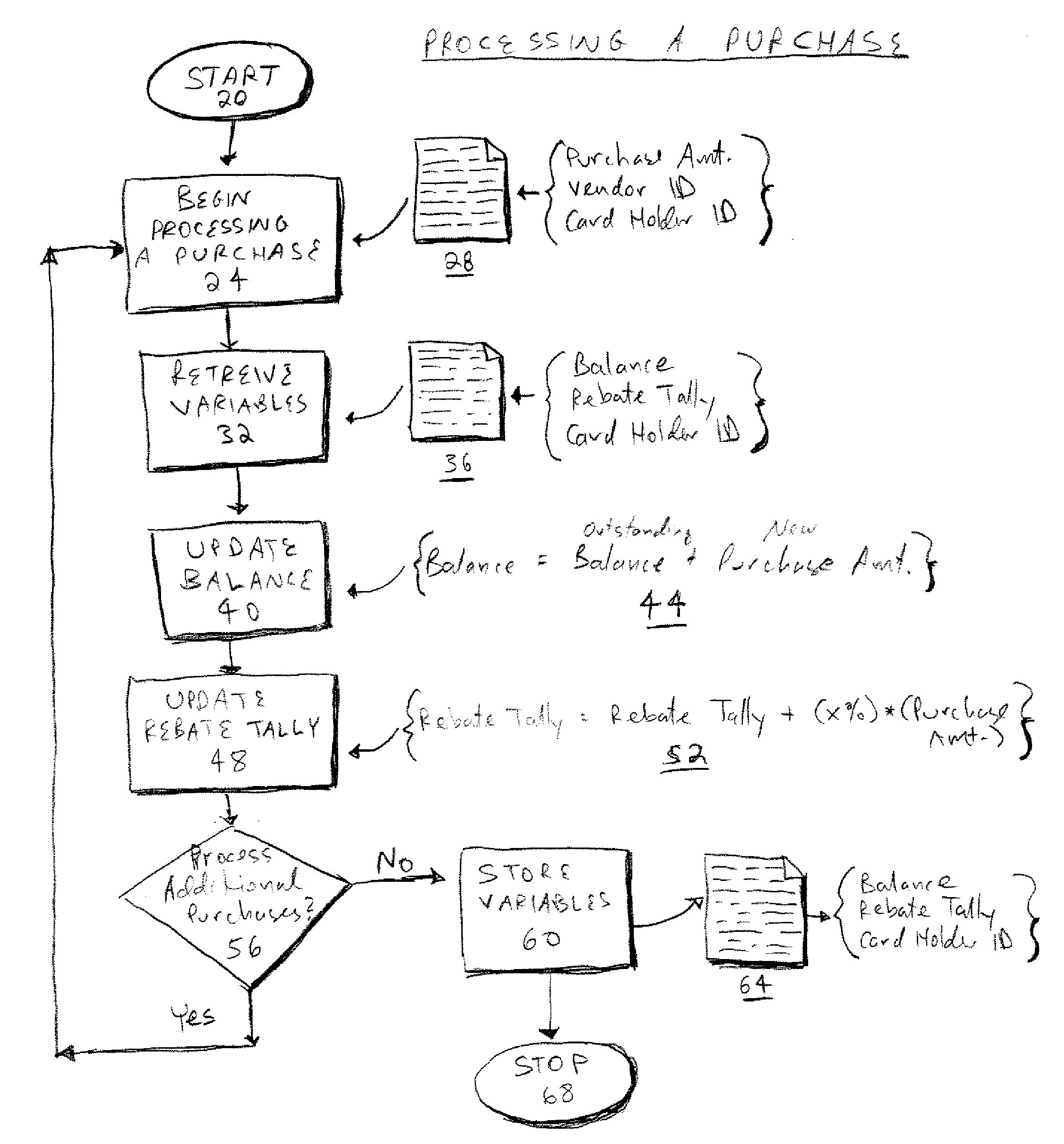

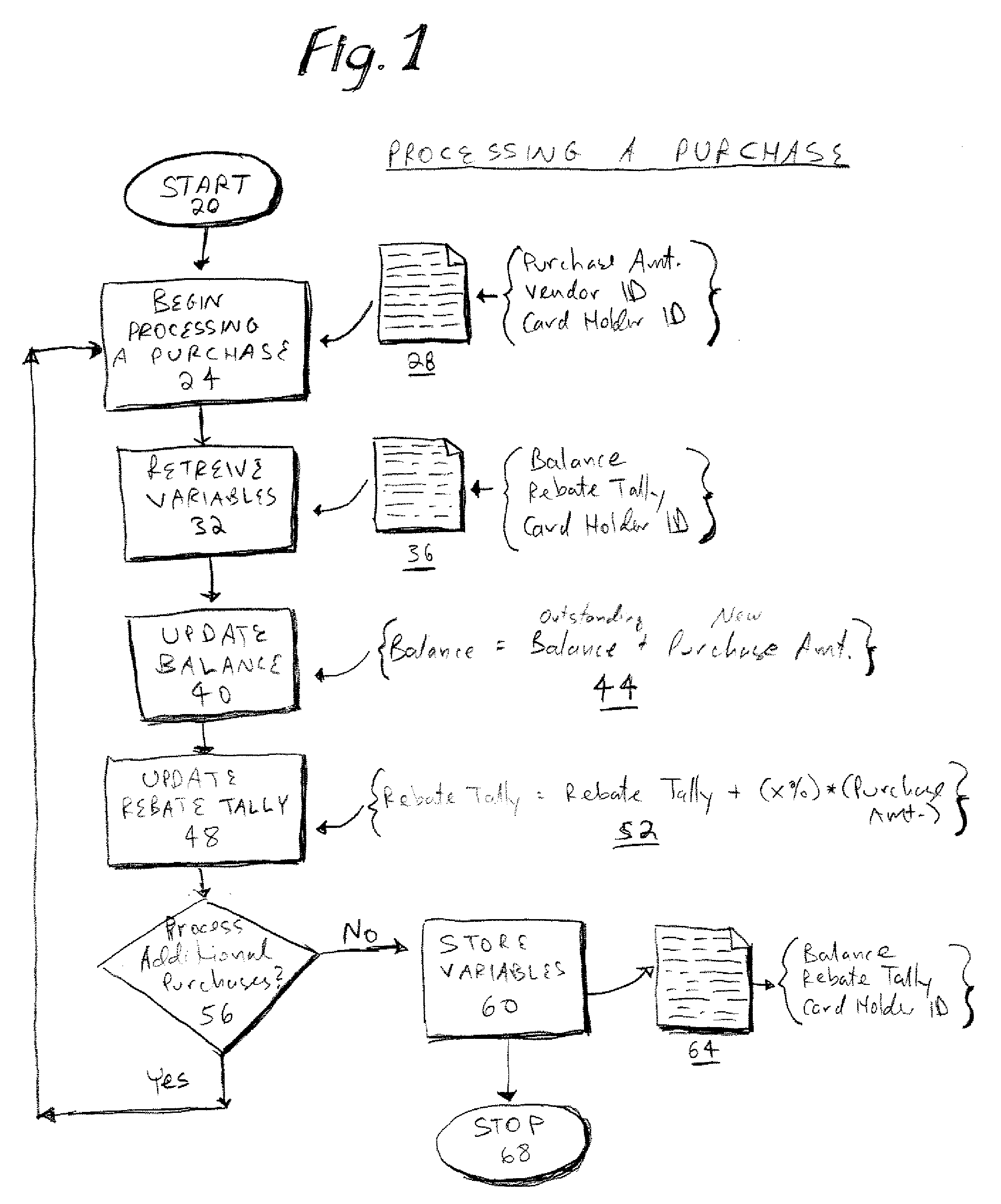

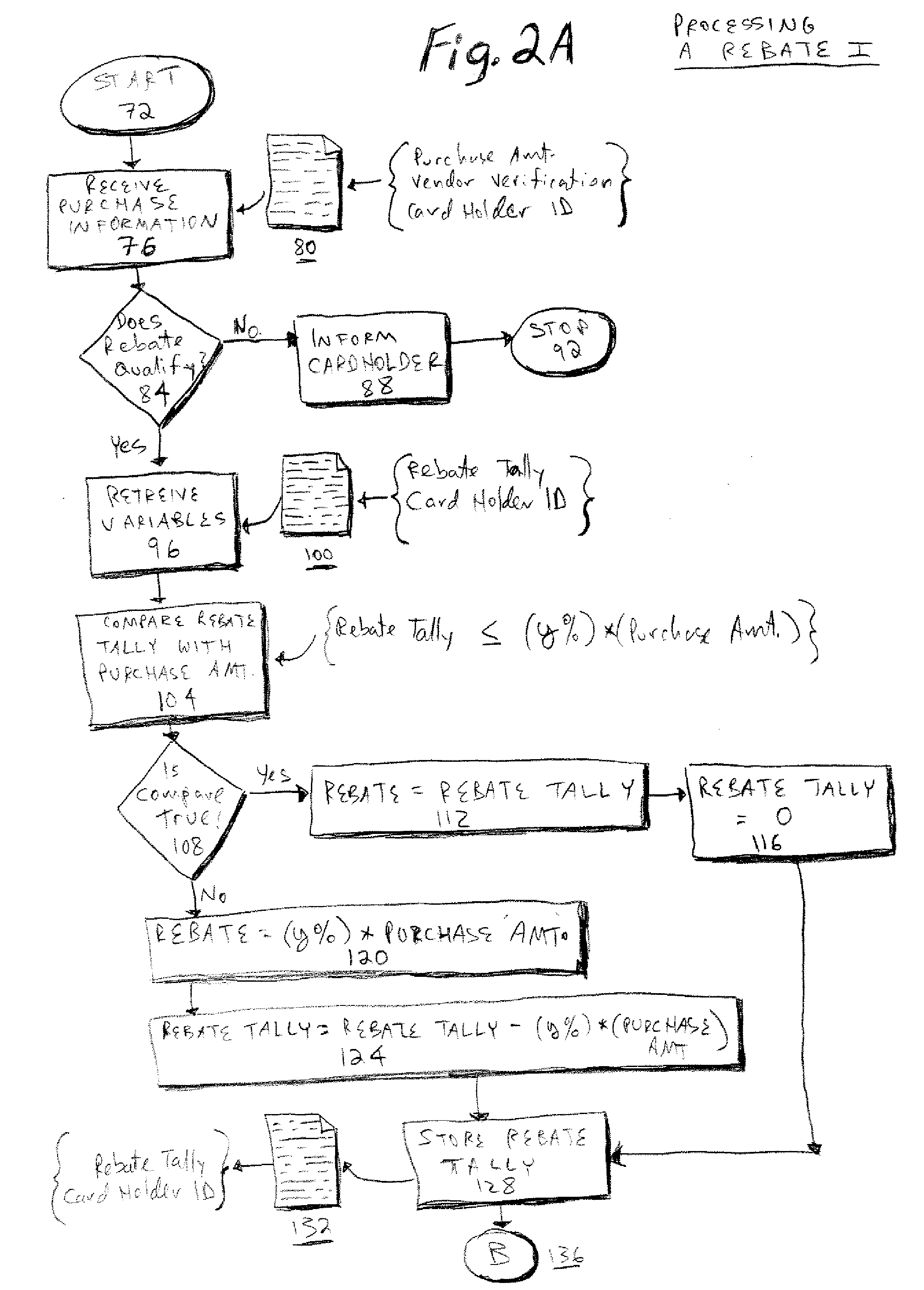

Method and system for awarding rebates based on credit card usage to credit card holders

InactiveUS20070288372A1Improve creditEncouraging increased useFinanceMarketingOperating systemCard holder

A method and system for awarding rebates based on credit card usage to a consumer credit card holder is provided. A rebate tally is accrued based on a percentage of eligible purchases made by the consumer card holder. The rebate is earned when the consumer card holder makes a qualifying purchase, which may be, for example, an automobile sold by any manufacturer. The rebate program disclosed does not associate the rebate earned with any particular manufacturer. The rebate is paid directly by the credit card issuer to the credit card holder.

Owner:CITIBANK

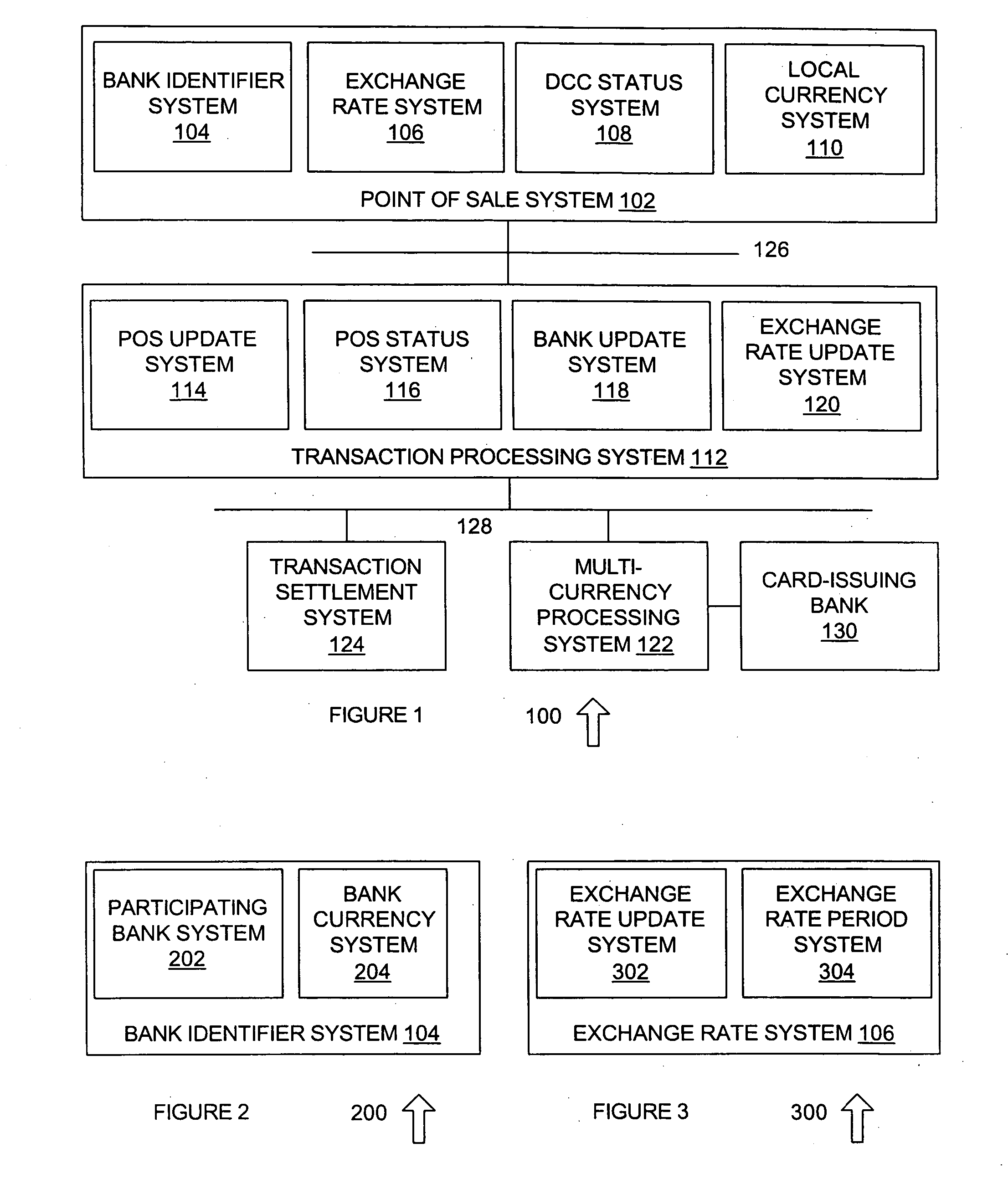

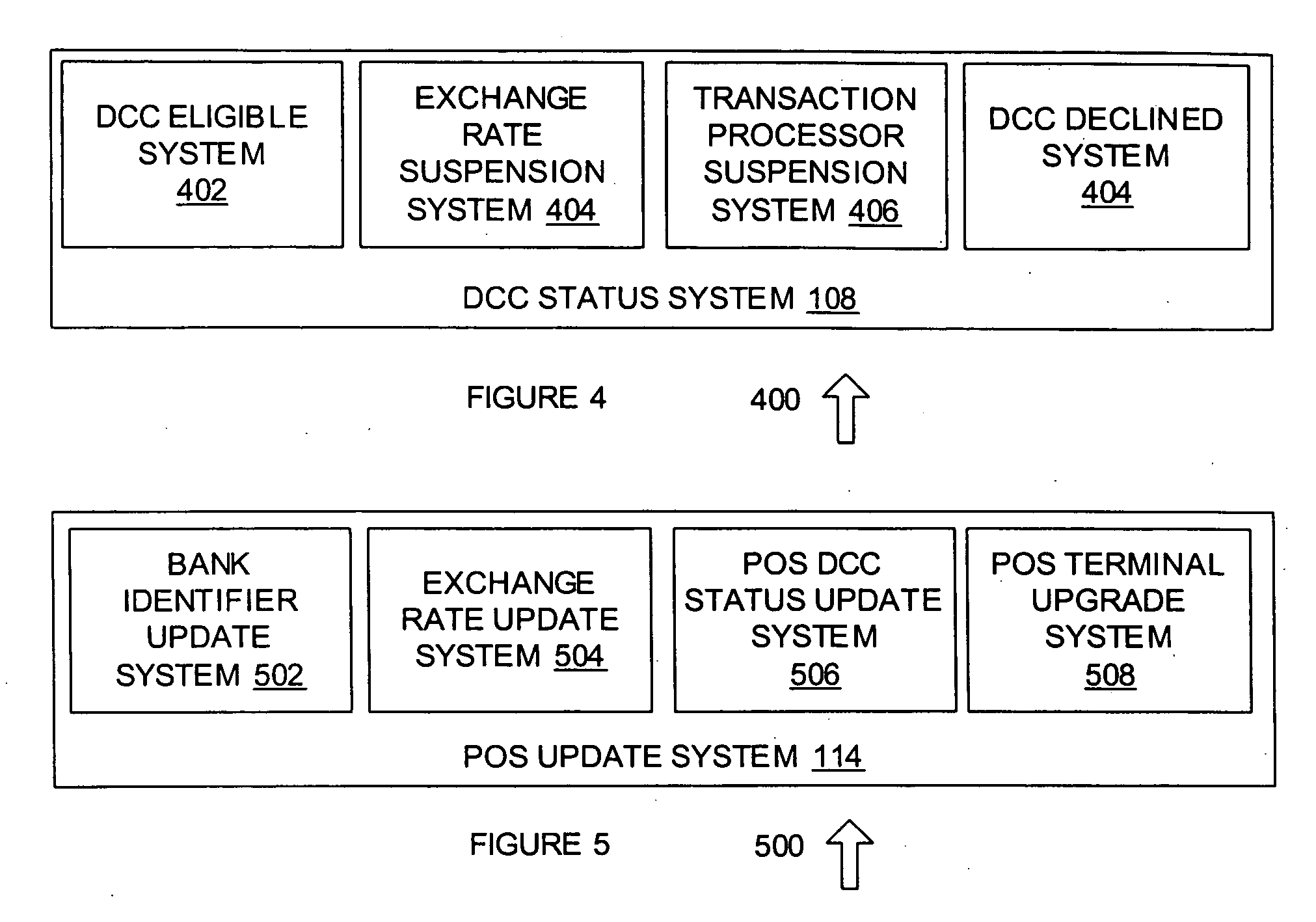

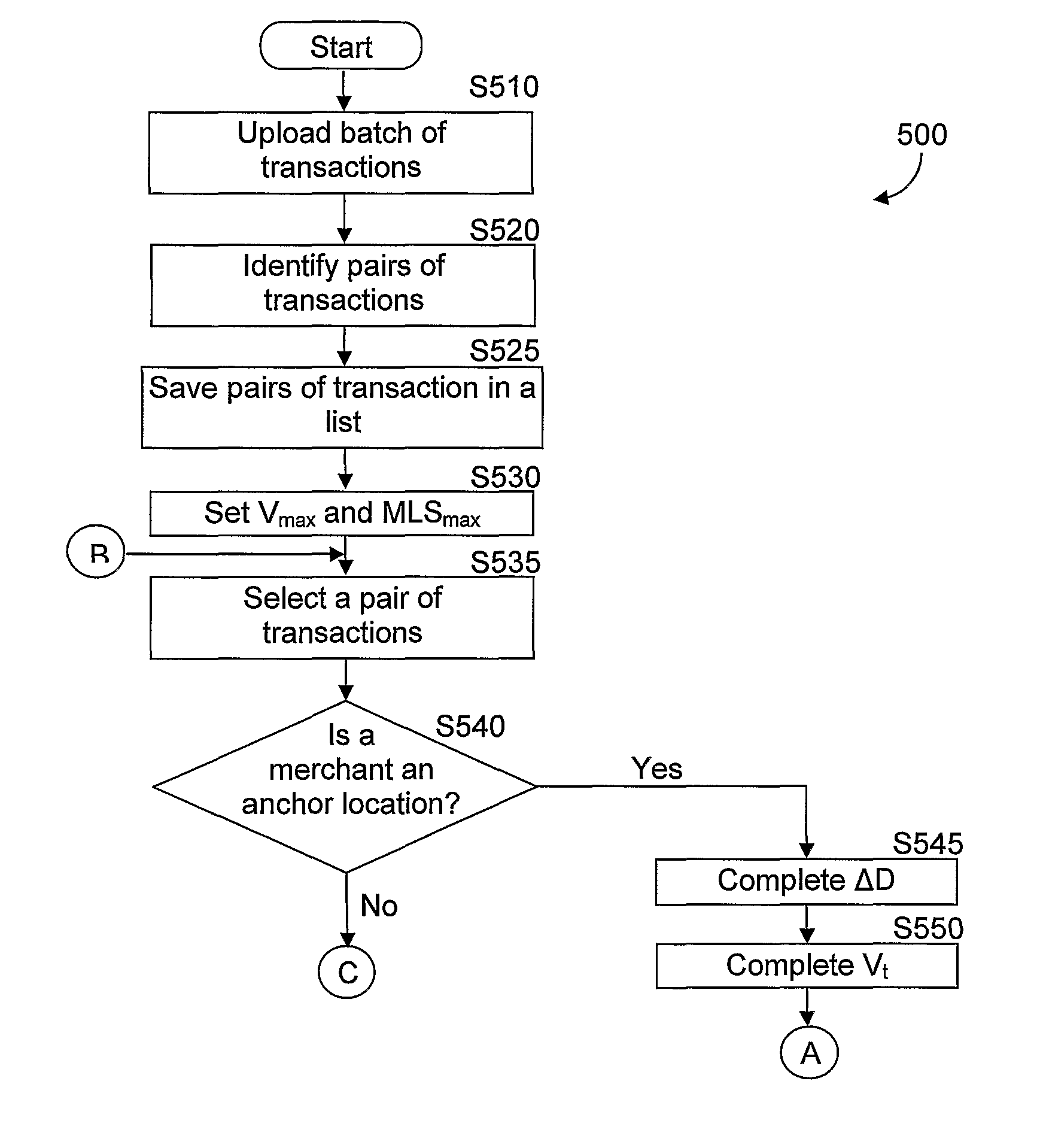

Dynamic currency conversion system and method

A system for dynamic currency conversion is provided. The system includes a bank identifier system determining whether currency conversion is available for a card-issuing bank of a presented card, such as by comparing a bank identifier from the card with a list or table of participating banks. An exchange rate system determines whether an exchange rate has expired, such as an exchange rate associated with the foreign currency of the card-issuing bank. The card holder is presented with an option for selecting a foreign currency transaction after it is determined that currency conversion is available for the card-issuing bank and that the exchange rate has not expired, such that the card holder does not need to see such information unless foreign currency processing is available.

Owner:PAYMENTECH INC

Location based authentication system

InactiveUS8285639B2Optimize locationFinanceBuying/selling/leasing transactionsBehaviour patternCard holder

An improved location based authentication (LBA) system for detecting fraudulent transactions committed by means of misuse of payment cards is disclosed. The improved LBA system performs a series of transaction analysis and generates a fraud-score which provides an indication as whether to authorize an attempted transaction. The system is designed to increase profitability of credit card companies by reducing the accumulated losses due to fraud. In one embodiment, the system detects fraud by analyzing the behavior patterns of card holders and merchants.

Owner:MCONFIRM

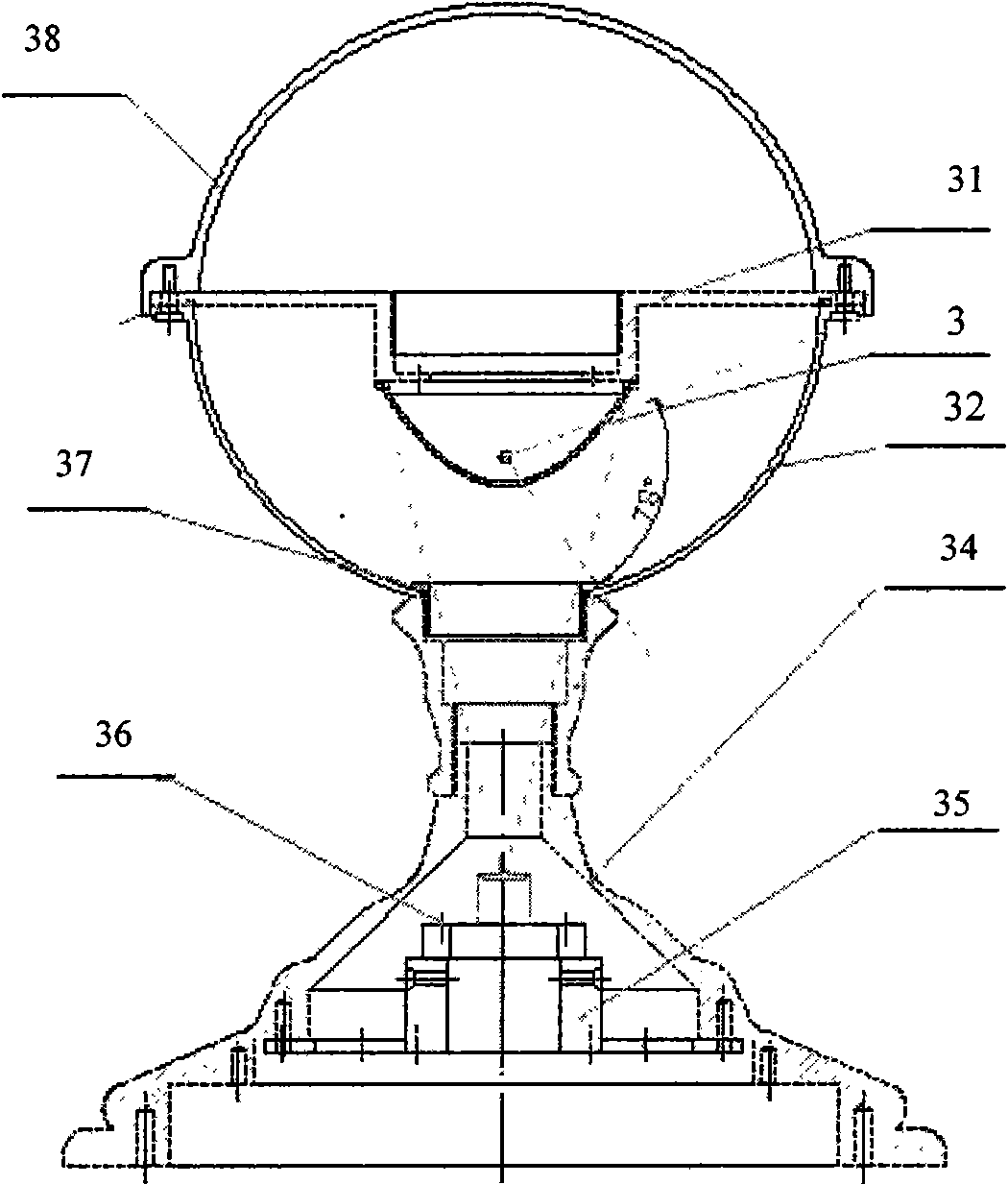

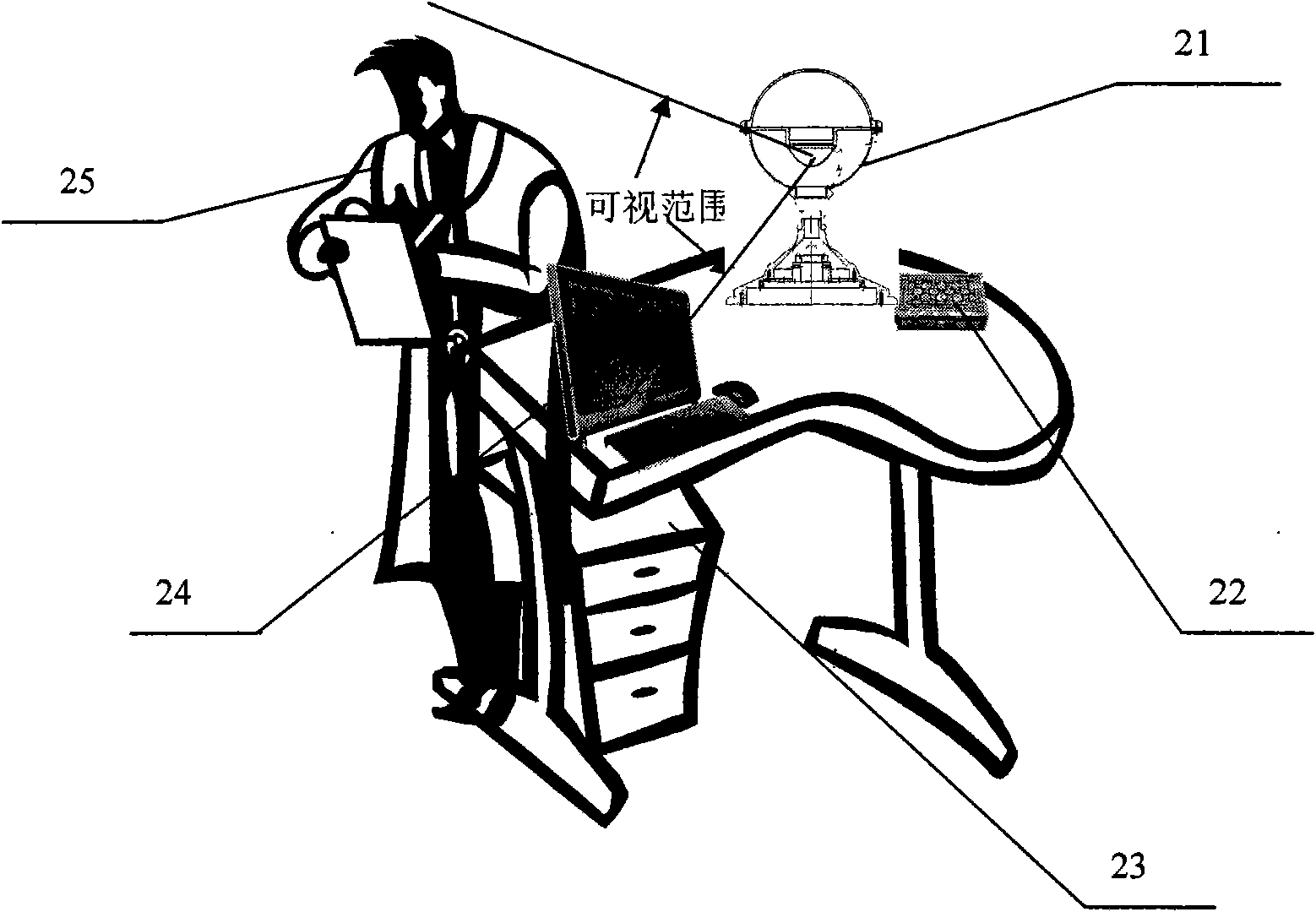

Biometrics-based device for detecting indentity of people and identification

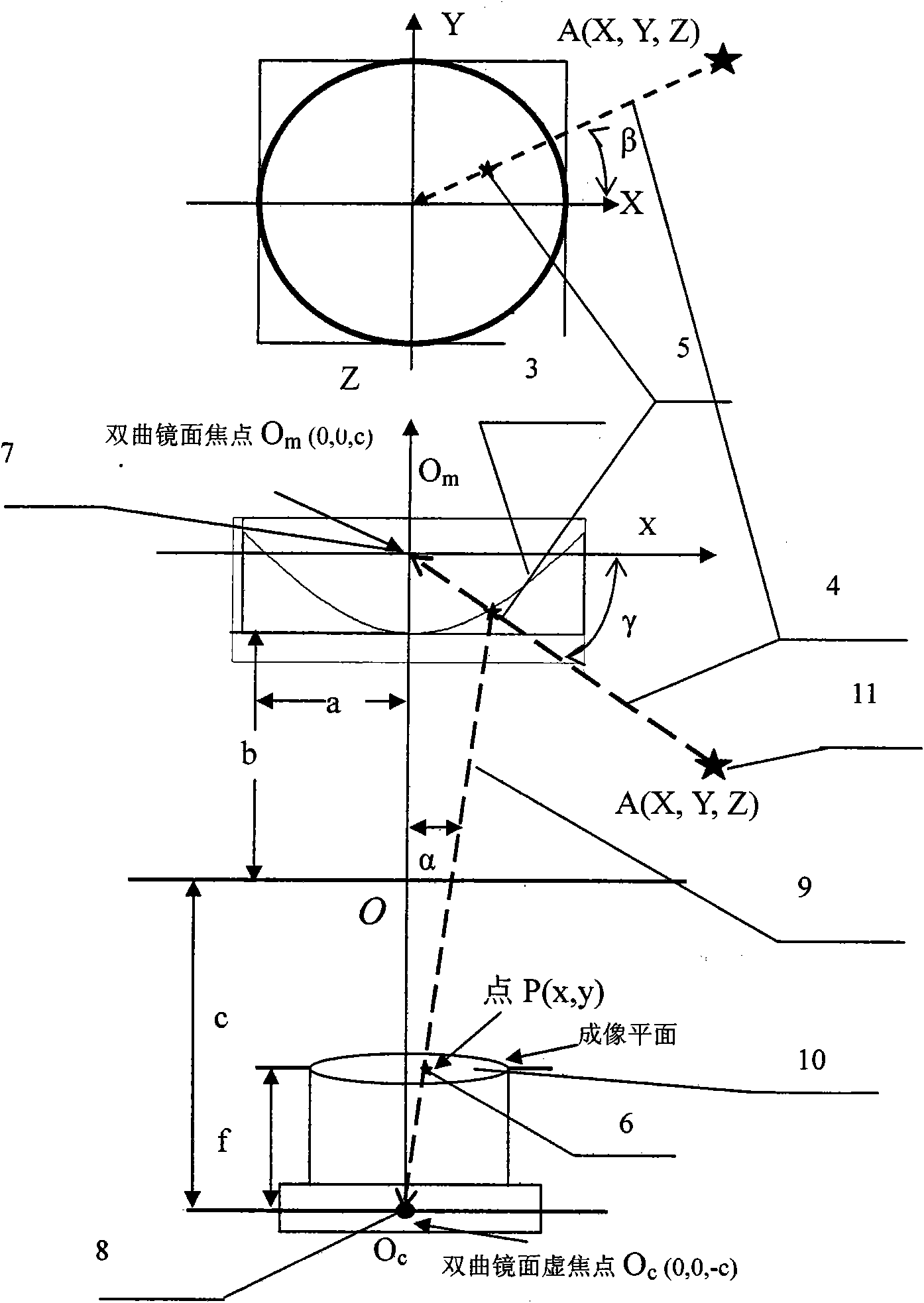

InactiveCN101669824AReduce work intensityReduce error ratePerson identificationCharacter and pattern recognitionFace detectionProcess module

The invention discloses a biometrics-based device for detecting identity of people and identification, which comprises an omni-directional vision sensor used for acquiring the facial image of an ID card holder, an ID card reader used for reading the photograph information in a bulit-in chip of the second-generation ID card and a microprocessor used for comparing whether the facial photograph imagestored in the built-in chip of the second-genration ID card and the facial images acquired by the omni-directional vision sensor are consistent or not, wherein the microprocessor comprises a data module used for reading photograph image in the ID card, a first facial detecting module, a first facial feature extraction module, a panoramicpicture reading module, a second facial detecting module, animage expanding module, a second facial feature extraction module, an identity detecting module for the biological feature of people and the ID card and a decision-layer voting and processing module.The device adopts biometrics identification technology, can greatly improve the efficiency for validating the ID card, and reduce the working strength and error rate of office personnels.

Owner:ZHEJIANG UNIV OF TECH

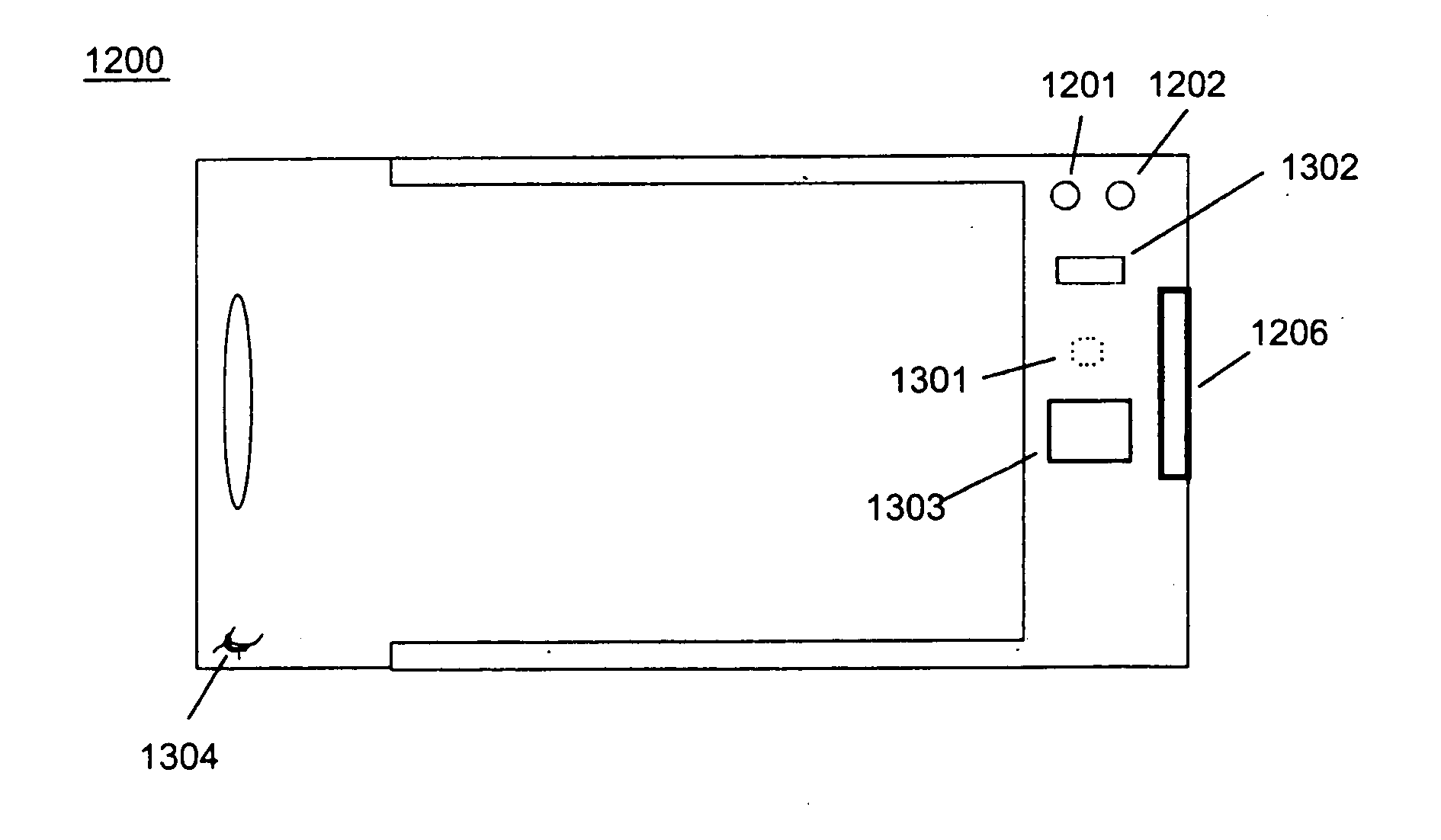

Intelligent ID card holder

InactiveUS20050077348A1Memory record carrier reading problemsSensing by galvanic contactsSensing dataMicrocomputer

An intelligent ID card holder comprises a receptacle for receiving the smartcard to facilitate intelligent ID card based transactions. The card holder further comprises one or more sensors of a user's features and a microcomputer for confirming the user's identity. The holder communicates with the ID card by electrical contacts or RF antenna. The sensor collects data representative of features of the current user of the card, and the microcomputer compares stored data in the memory with the sensed data to determine whether the current user is the authentic user. In a preferred embodiment, the intelligent ID card holder comprises a card holder with a cutaway viewing area showing a portion of the ID card surface, such as a photograph of the authentic user, while the ID card is inserted in the holder.

Owner:HENDRICK COLIN

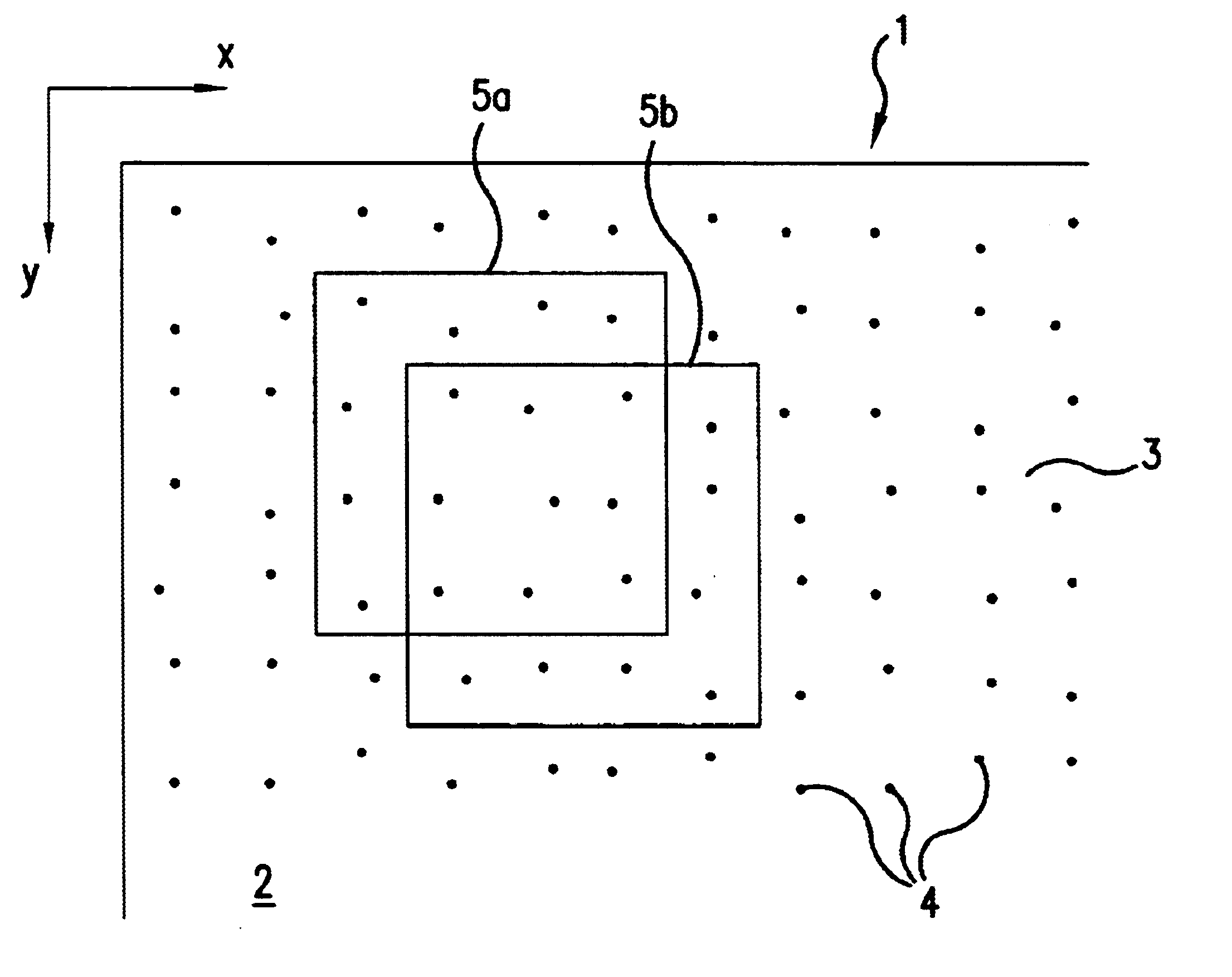

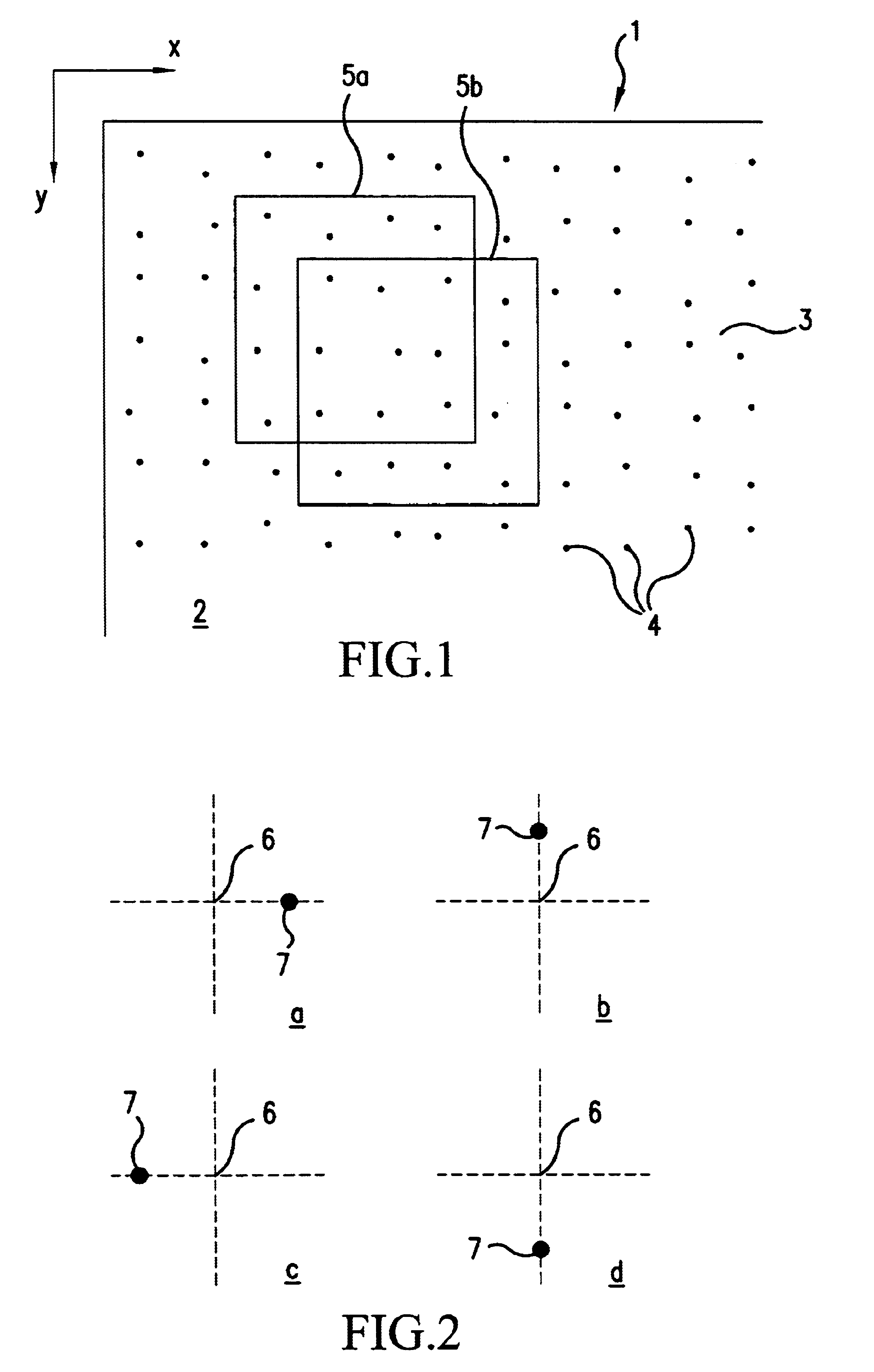

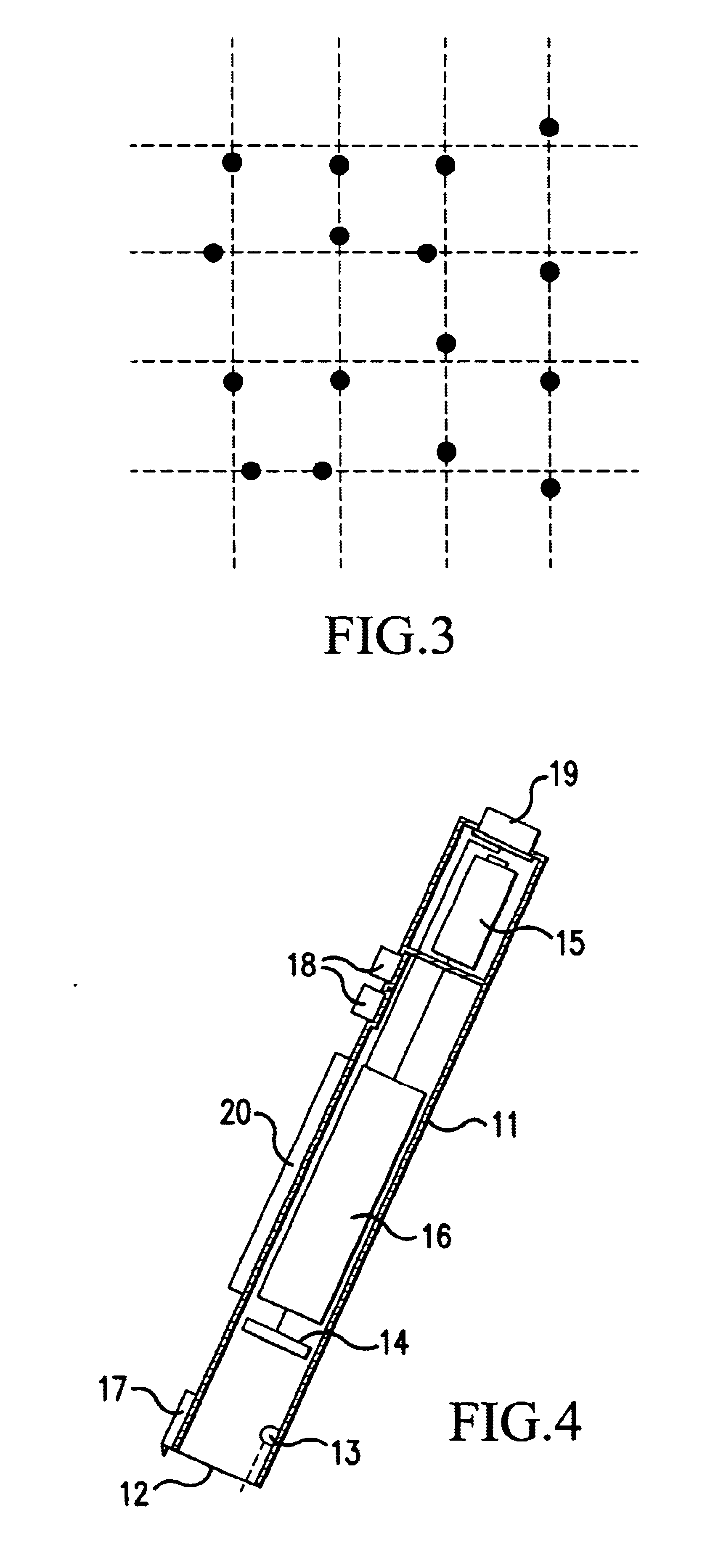

Business card

InactiveUS6722574B2Input/output for user-computer interactionCharacter and pattern recognitionBusiness cardThe Internet

A business card and a pen, which is adapted to detect a position-coding pattern on the business card and calculate a coordinate by means of the pattern. When activating a send box by means of the pen, a computer sends a .vcf file containing the card holder's particulars to a card recipient belonging to the pen holder. When using an optional pen, the .vcf file is sent to a recipient indicated on the keypad of a mobile phone or written on the business card in associated fields or marked in other manners. The pen communicates with a computer wirelessly, for instance via Bluetooth, mobile phone and the Internet. Additional information can be drawn on the back of the business card and be attached to the transmission, such as date and time for the next meeting, a small drawing or sketch etc.

Owner:ANOTO AB

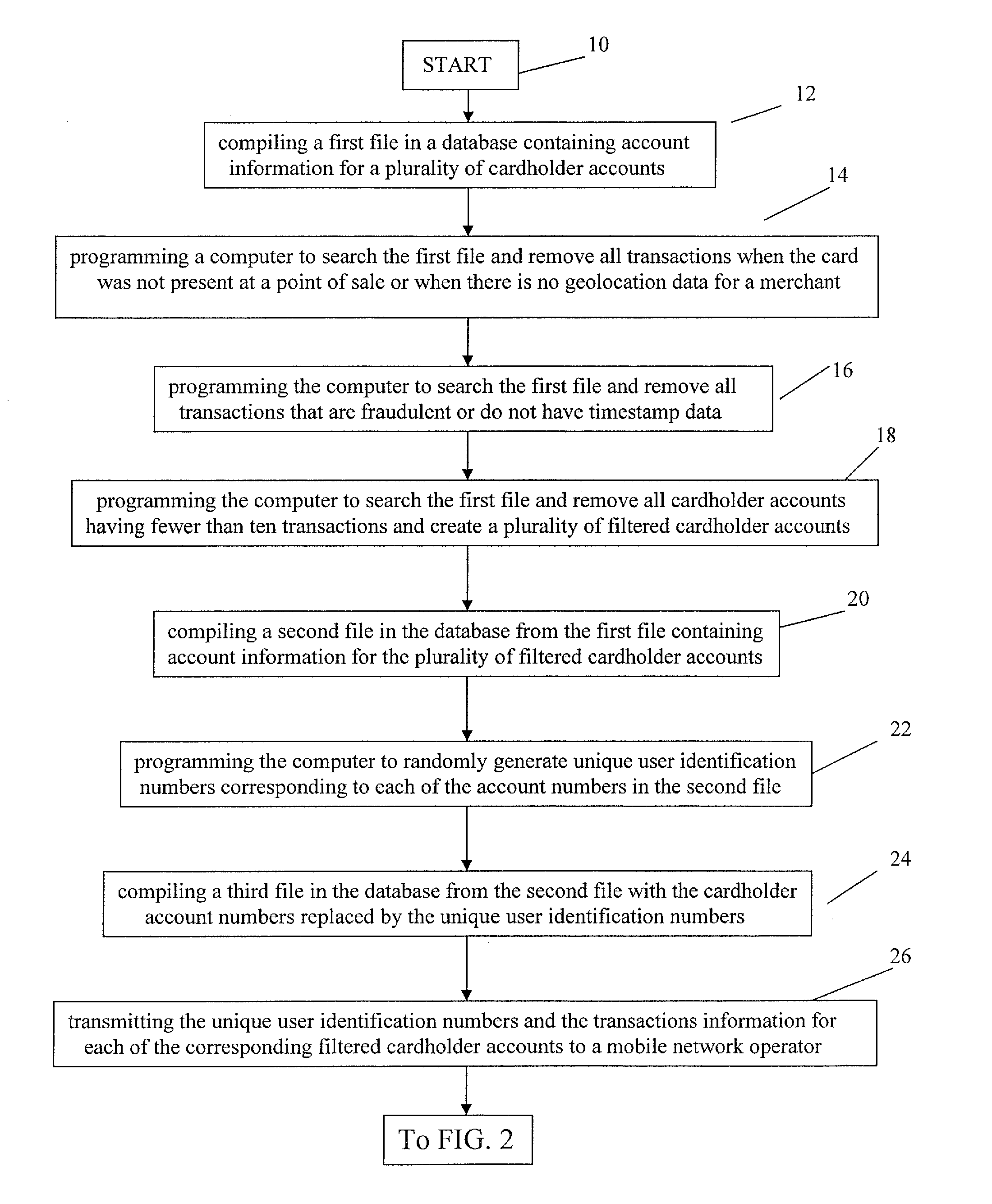

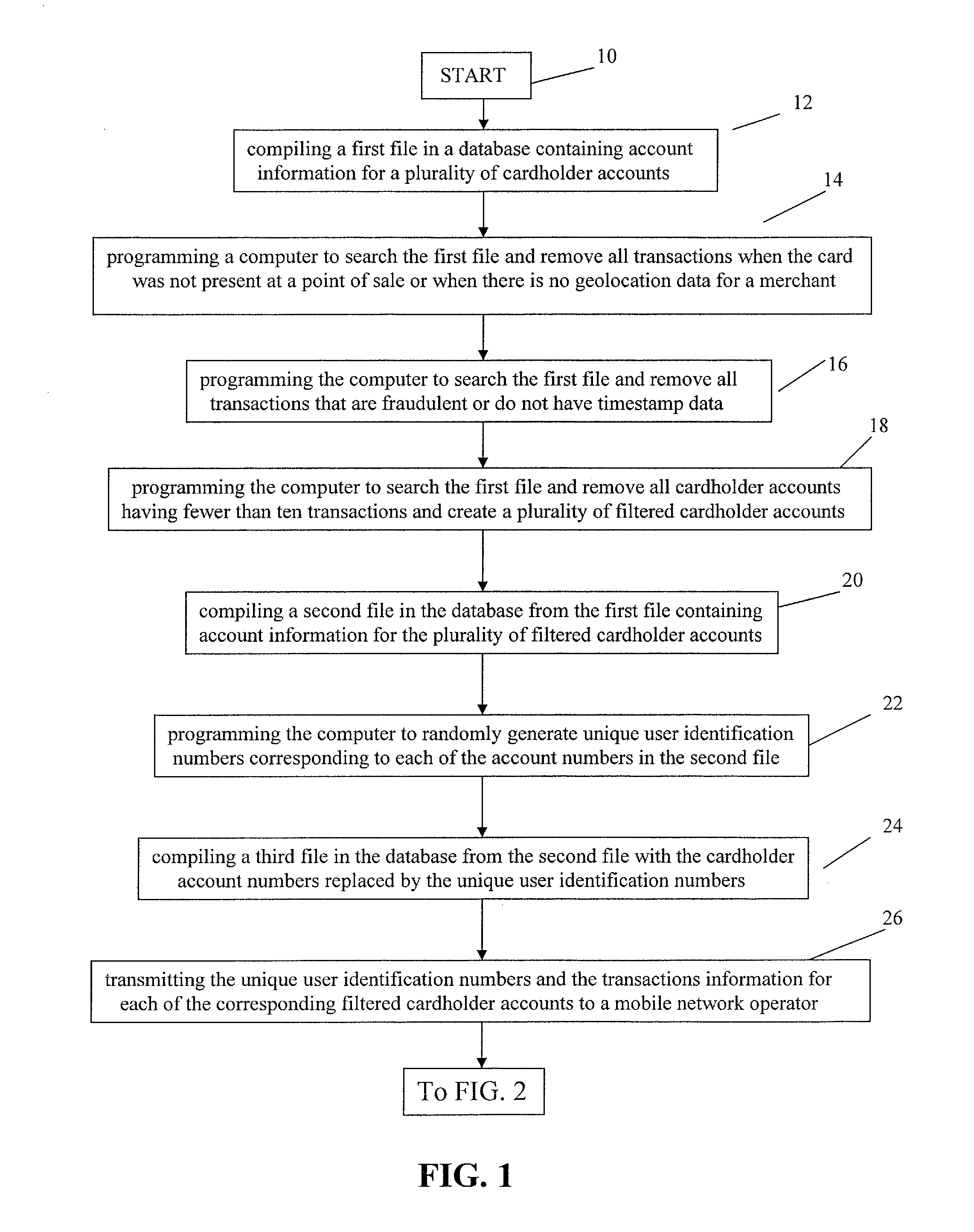

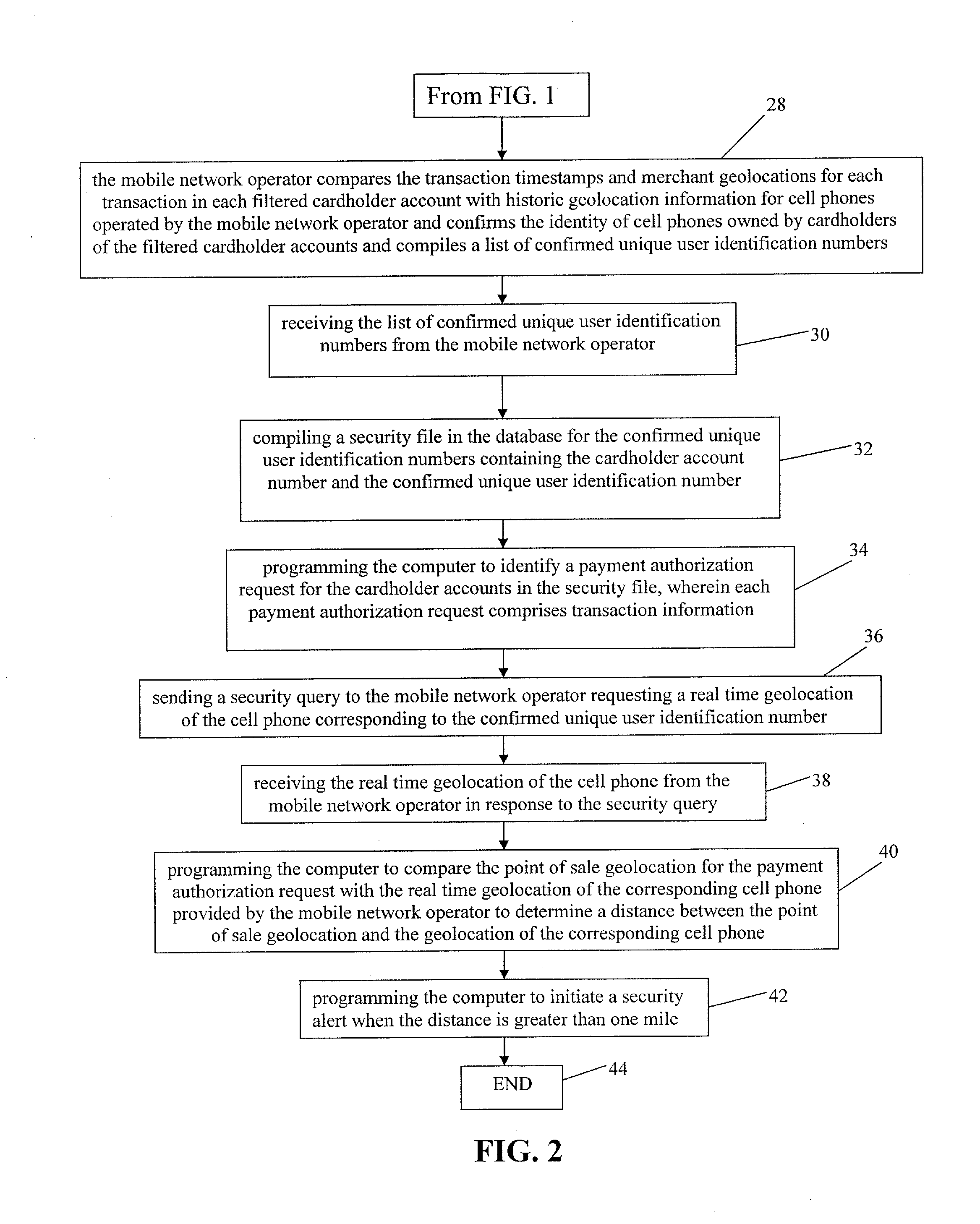

Method for Providing Payment Card Security Using Registrationless Telecom Geolocation Capture

InactiveUS20130290119A1Point-of-sale network systemsProtocol authorisationMobile Telephone NumberGeolocation

A method for providing registrationless payment card security for a payment network that includes maintaining a list of anonymous mobile telephone numbers, which correspond to personal payment card account numbers (PAN). When a card-present authorization for a listed PAN is received, the payment network requests the geolocation of the cell phone of the card holder in real time from the mobile network operator. The mobile network operator determines the geolocation of the cell phone and transmits it to the payment network. The payment network compares the geolocation of the cell phone with the geolocation of the merchant to confirm that the card holder is present at the location of the transaction.

Owner:MASTERCARD INT INC

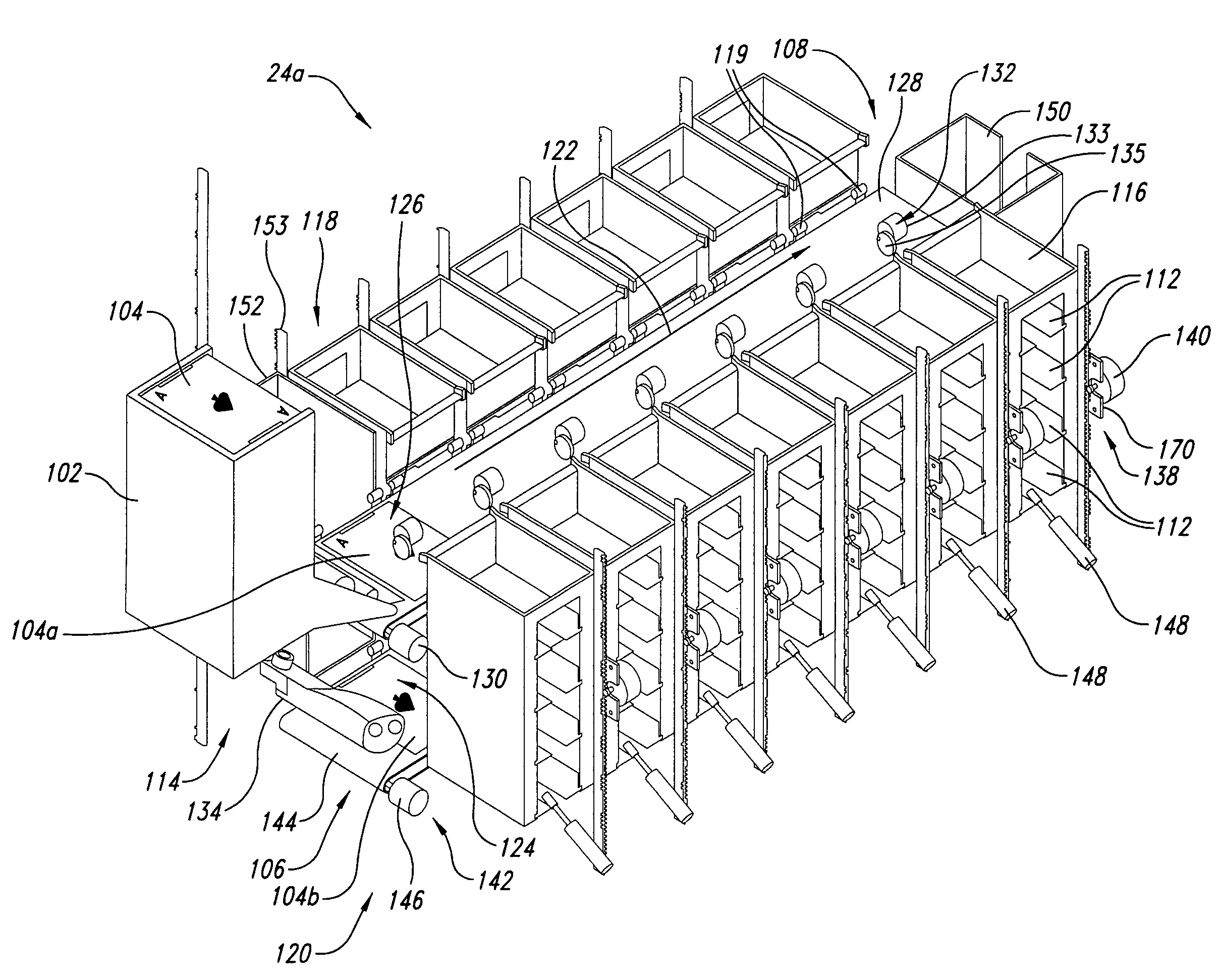

High-capacity card holder and ejector

InactiveUS20050224149A1Efficient storageReduce manufacturing costOther accessoriesTray containersEngineeringCard holder

Owner:ACM ENTERPRISE

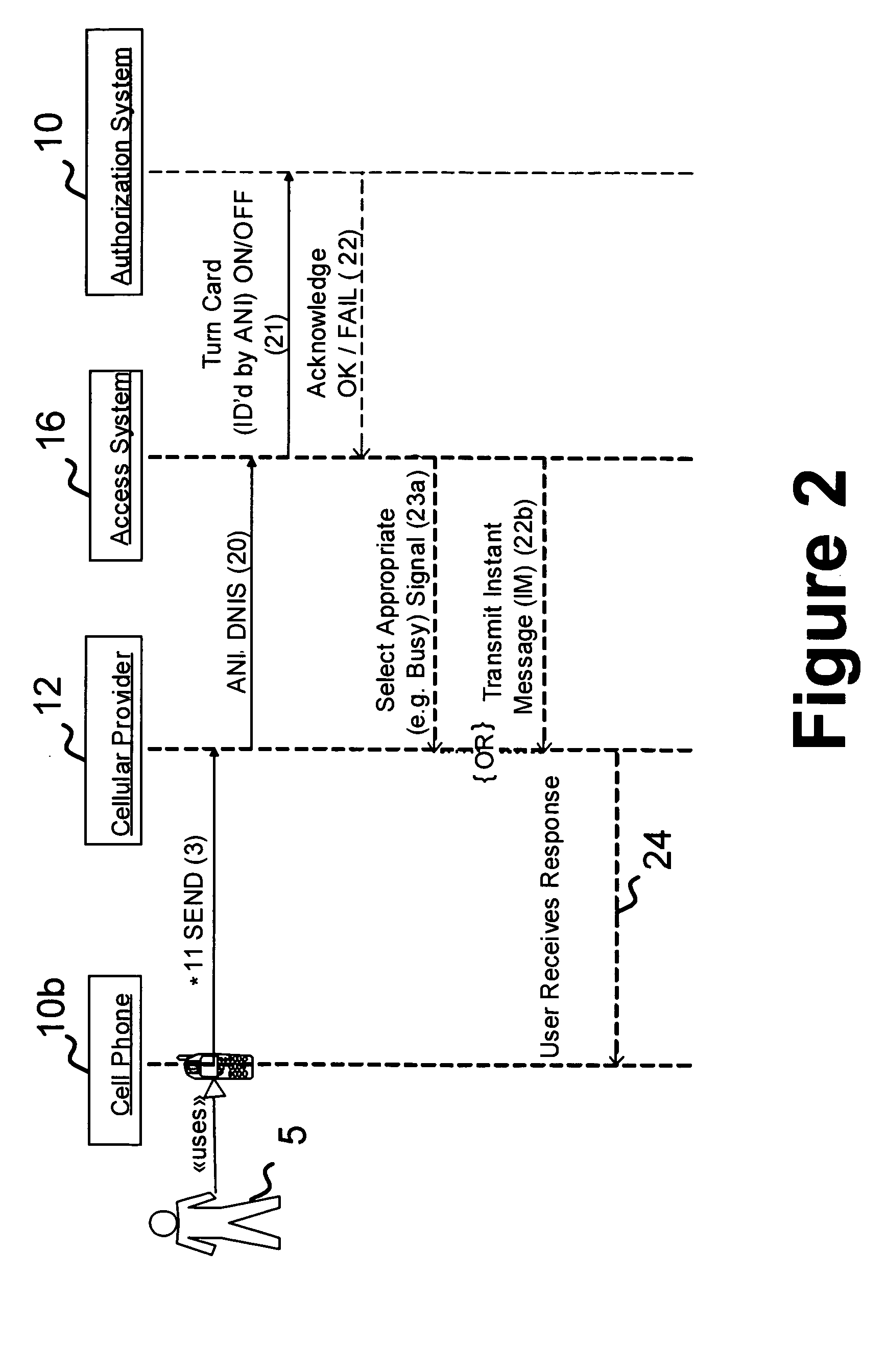

Systems and methods for remote account control

ActiveUS7229006B2Reduce the possibilityEffectively turn the card OFFComplete banking machinesFinanceControl systemCard holder

Systems and methods for remotely causing a request for authorization to charge a card, that is otherwise active, to be denied. In one embodiment, an access controller receives a call from a card holder and analyzes ANI and DNIS data received during call setup for the call to select a card account and an action (e.g., turn account OFF) to be taken with respect to the card account. The access controller formulates and sends a message to an account authorization processing system to cause the account authorization processing system to thereafter deny requests for authorization to charge the card account. A subsequent call to the access controller from the same caller (i.e., a same ANI) will reverse account closure and allow card authorization to proceed. Feedback, in the form of an Instant Message (IM), email, or audible signal (busy, ringing) when making the call, may be provided to indicate the success of a change to the state of the account. Embodiments that do not rely on PSTN infrastructure are also disclosed.

Owner:RBA INT +1

RFID shielding devices

InactiveUS20070289775A1Limited rangePrevent theftMagnetic/electric field screeningRecord carriers used with machinesElectronic accessCredit card

Unauthorized electronic access to RFID devices embedded in credit cards, personal identification cards, and other cards is prevented by providing wallets, purses, card holders, and other card receiving devices with layers of electromagnetic shielding material which substantially surround cards having RFID devices embedded therein.

Owner:EMVELOPE

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com