Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

4409 results about "Process module" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A process module represents a.dll or .exe file that is loaded into a particular process. A ProcessModule instance lets you view information about a module, including the module name, file name, and module memory details. A process can load multiple modules into memory.

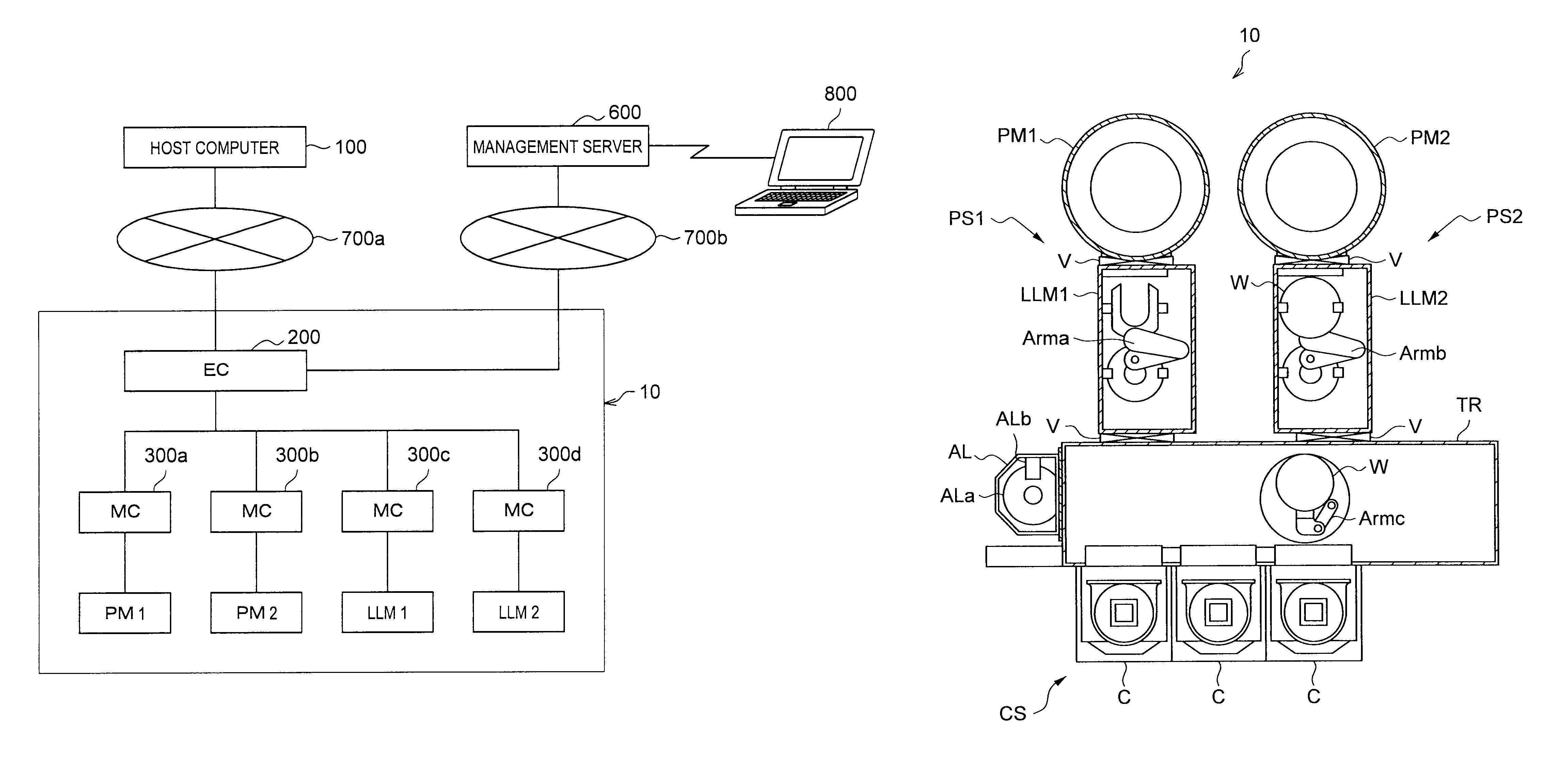

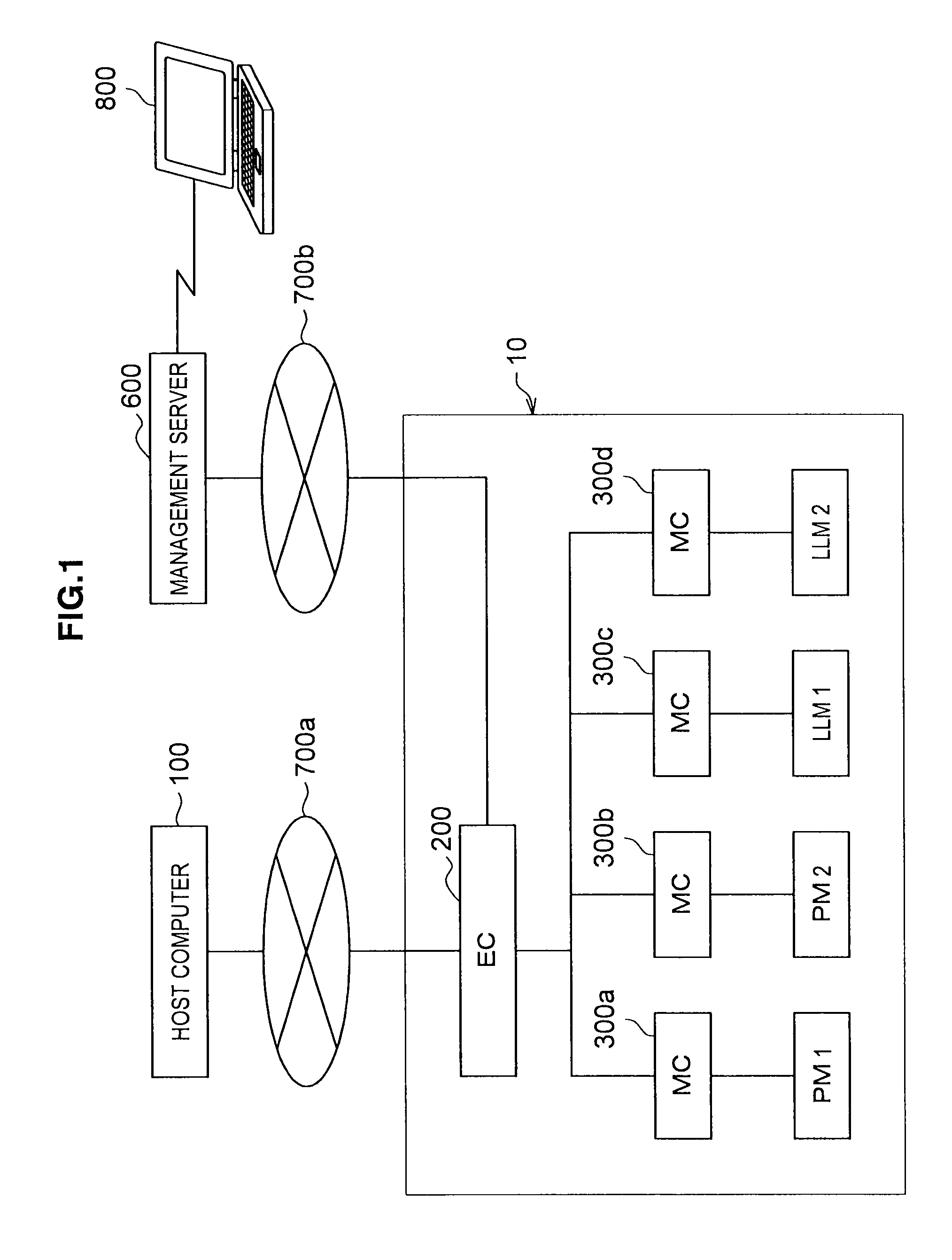

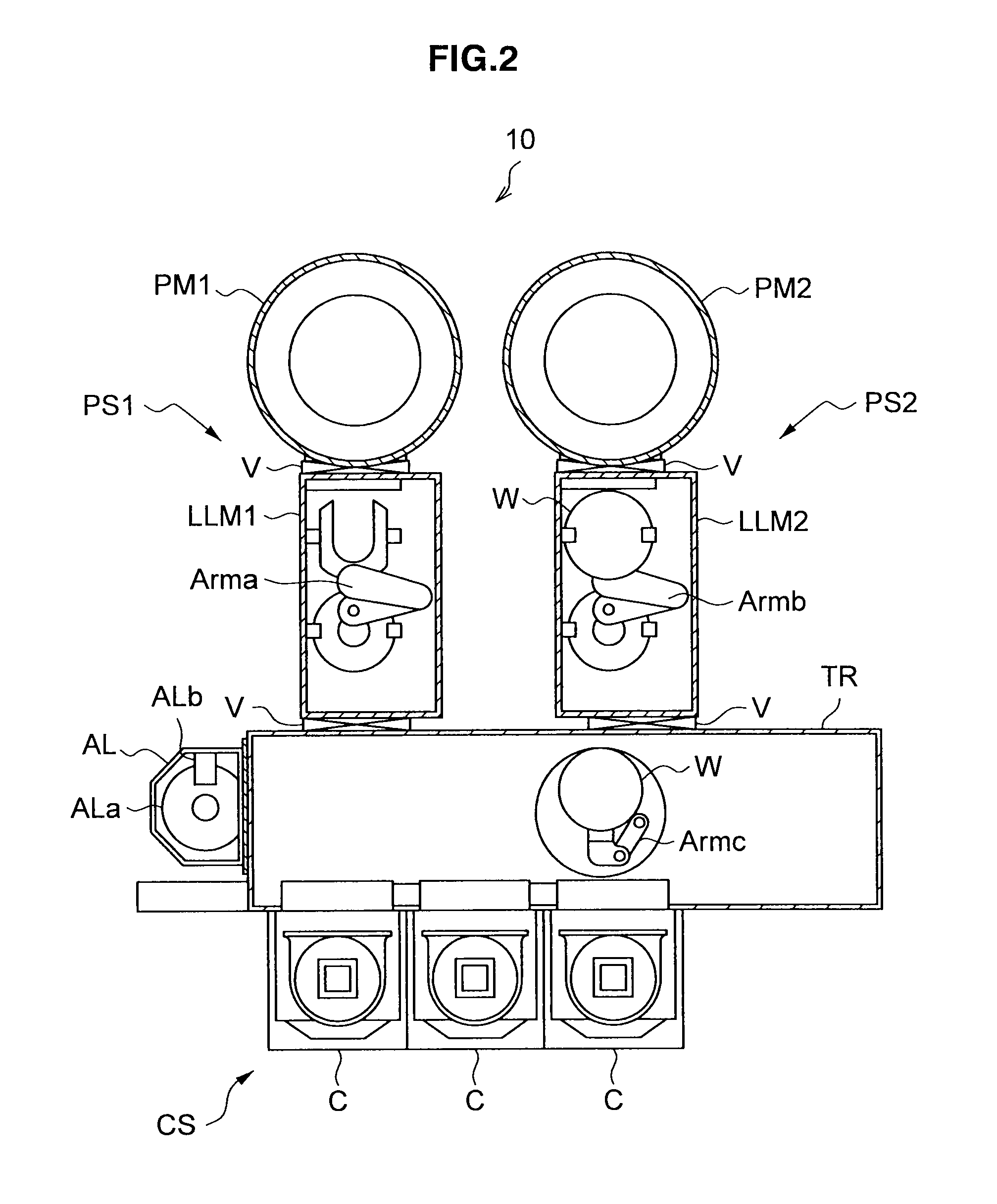

Device for controlling processing system, method for controlling processing system and computer-readable storage medium stored processing program

ActiveUS8055378B2Production of product can be suppressedIncrease productionProgramme controlDigital data processing detailsProcess moduleComputer module

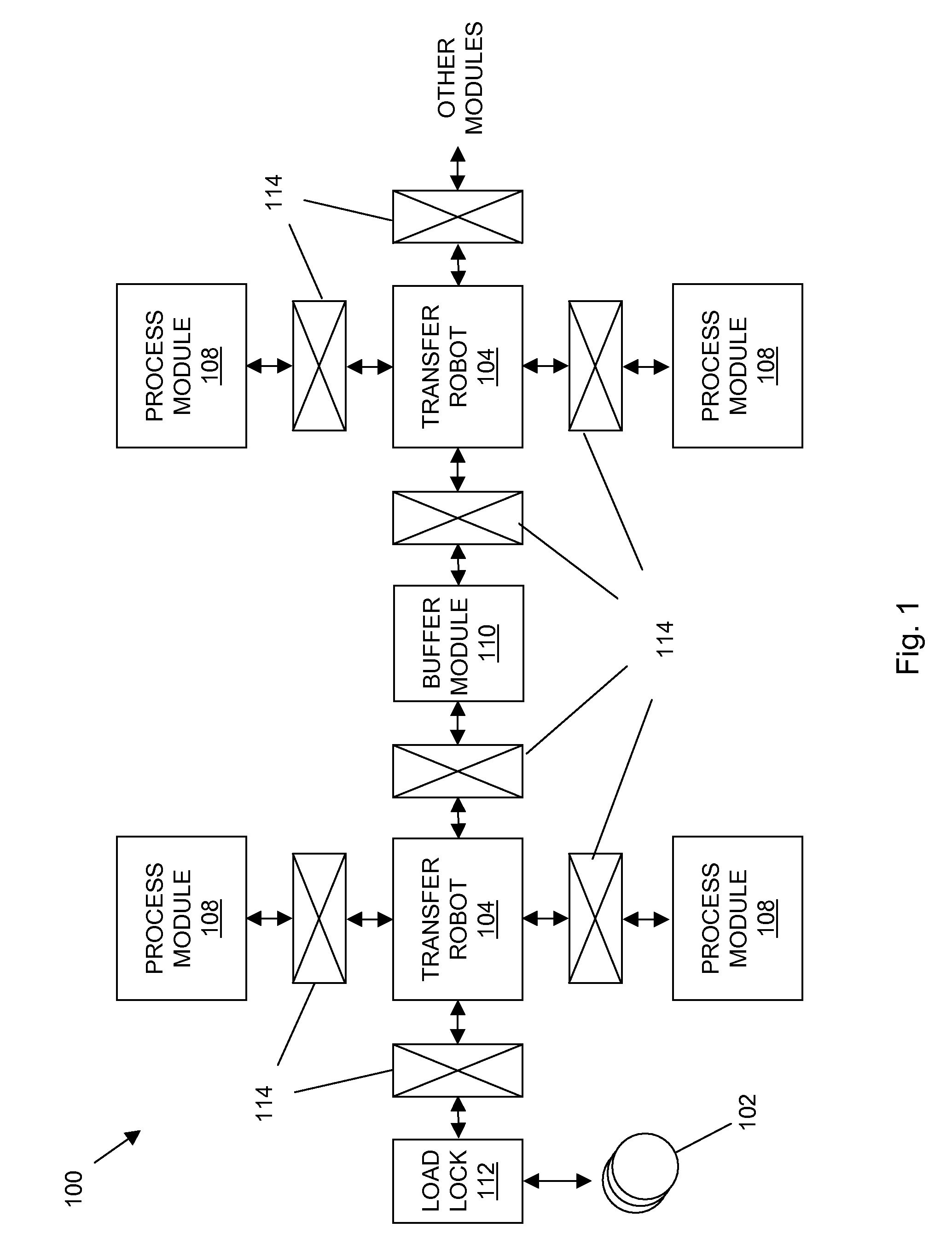

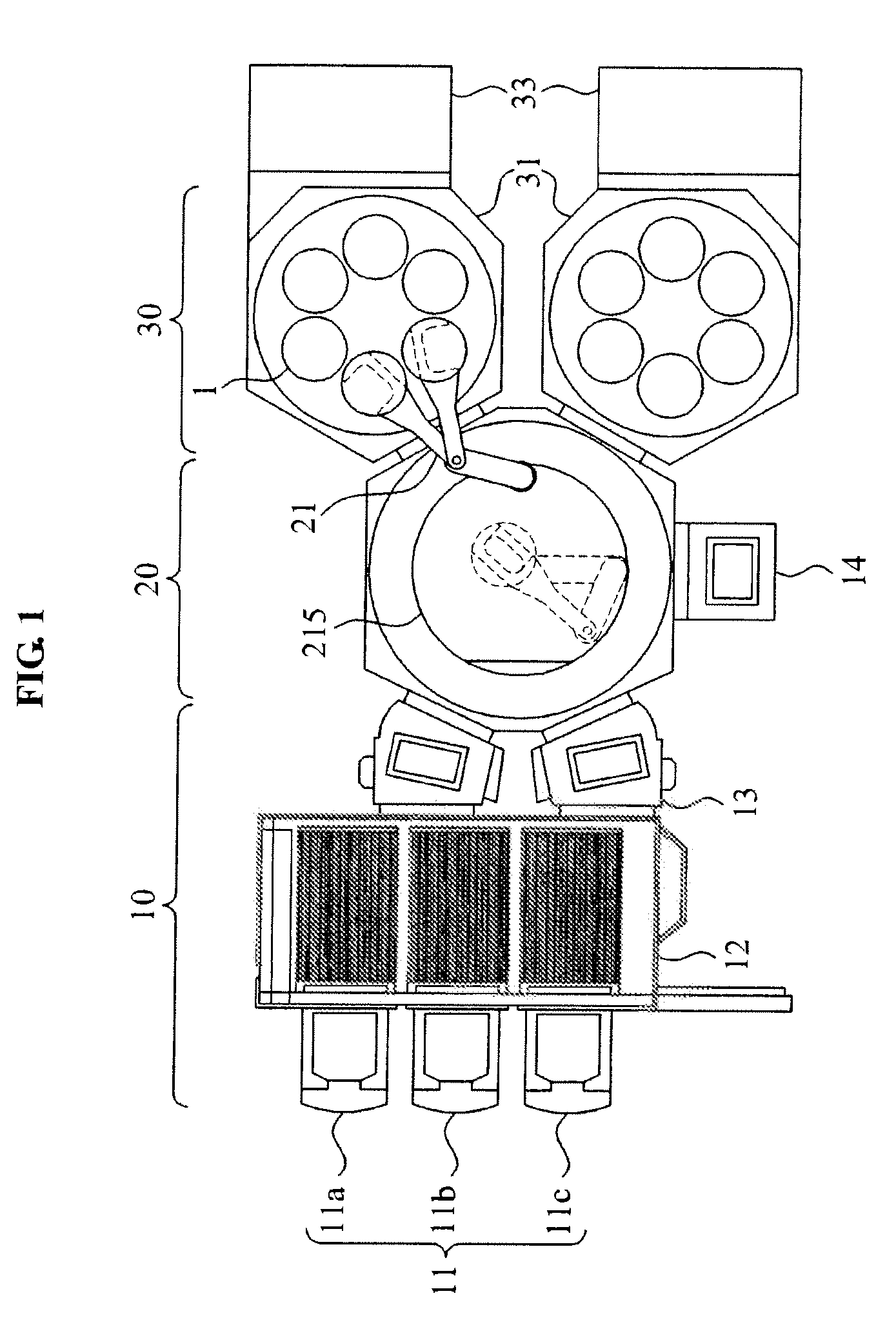

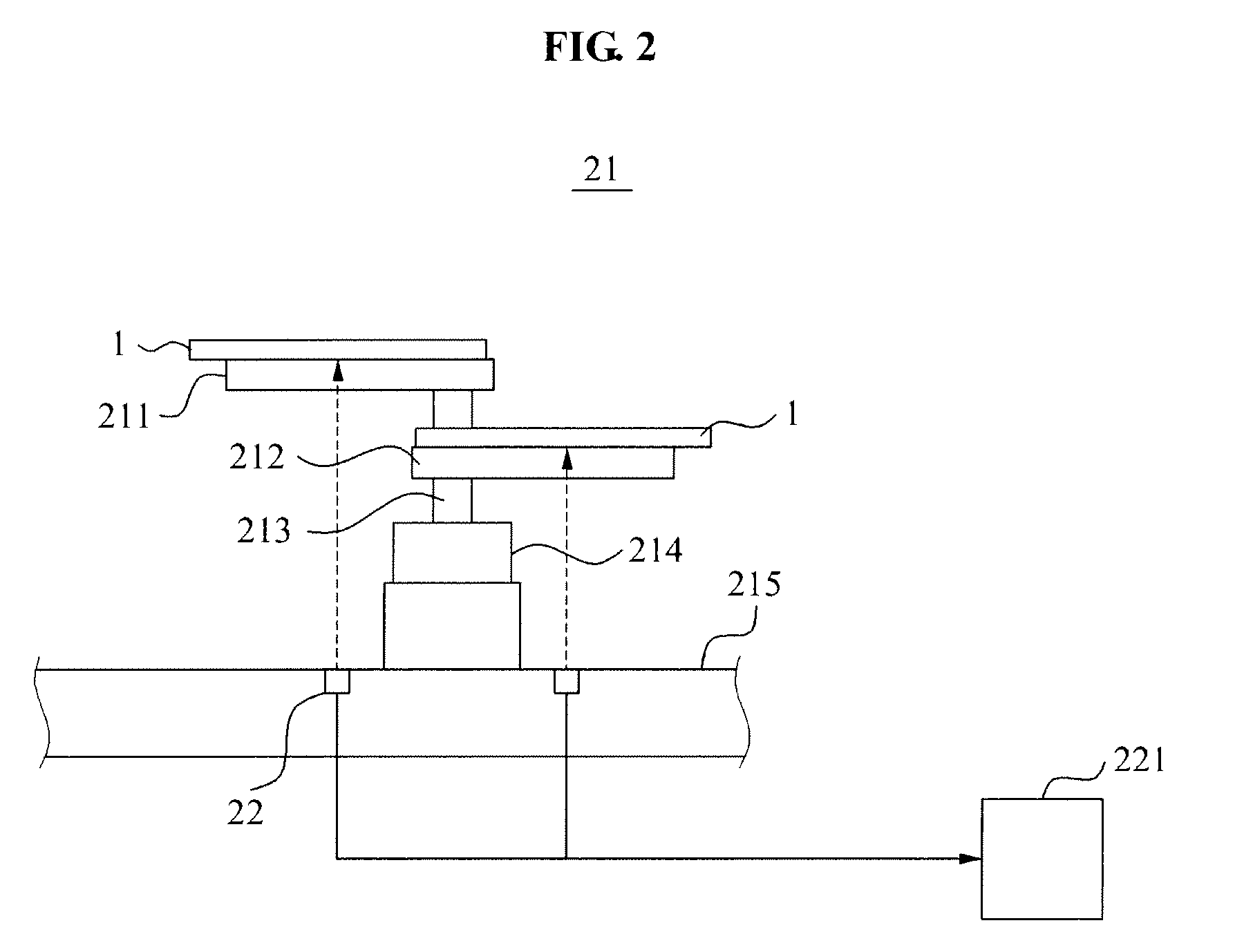

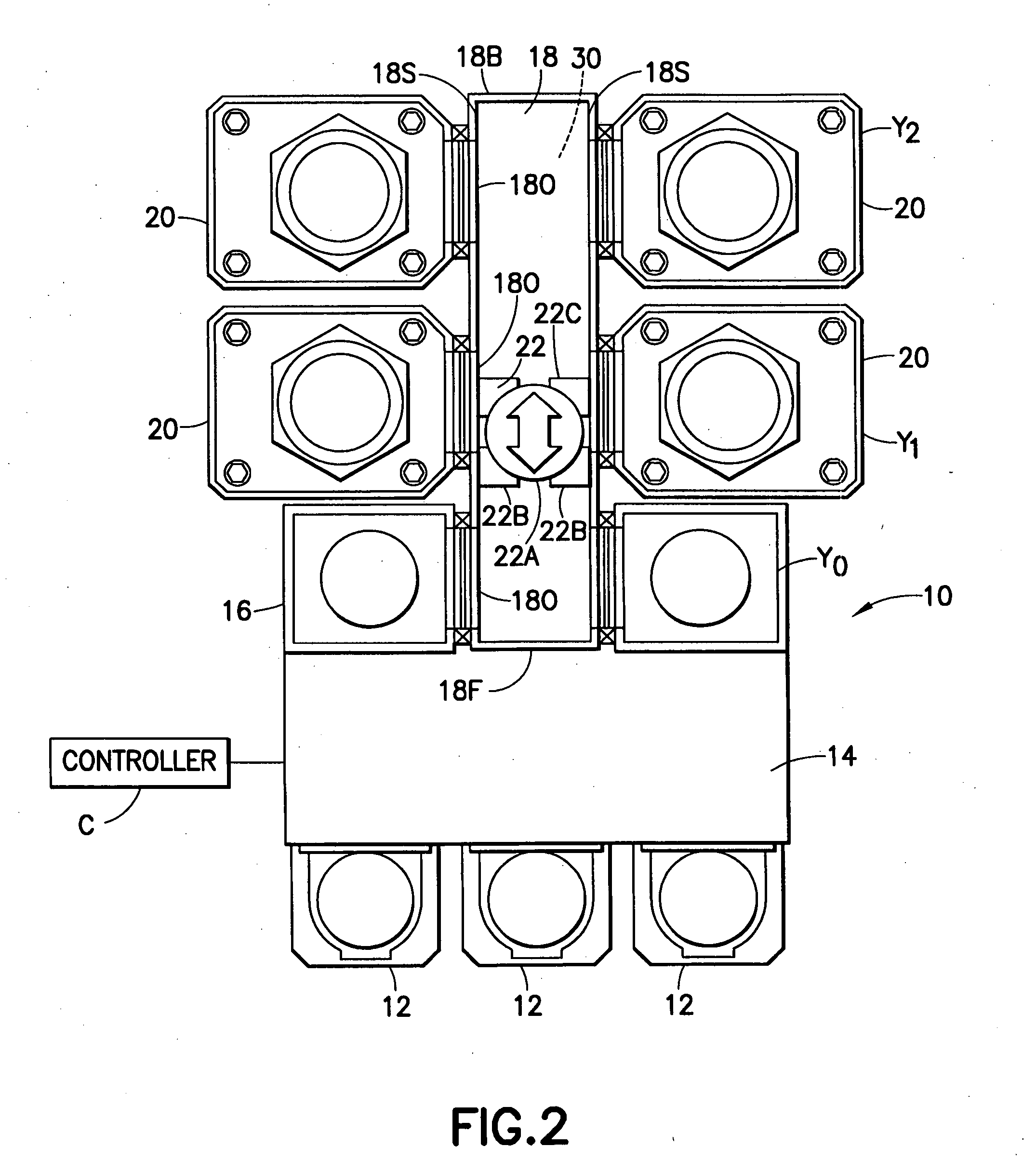

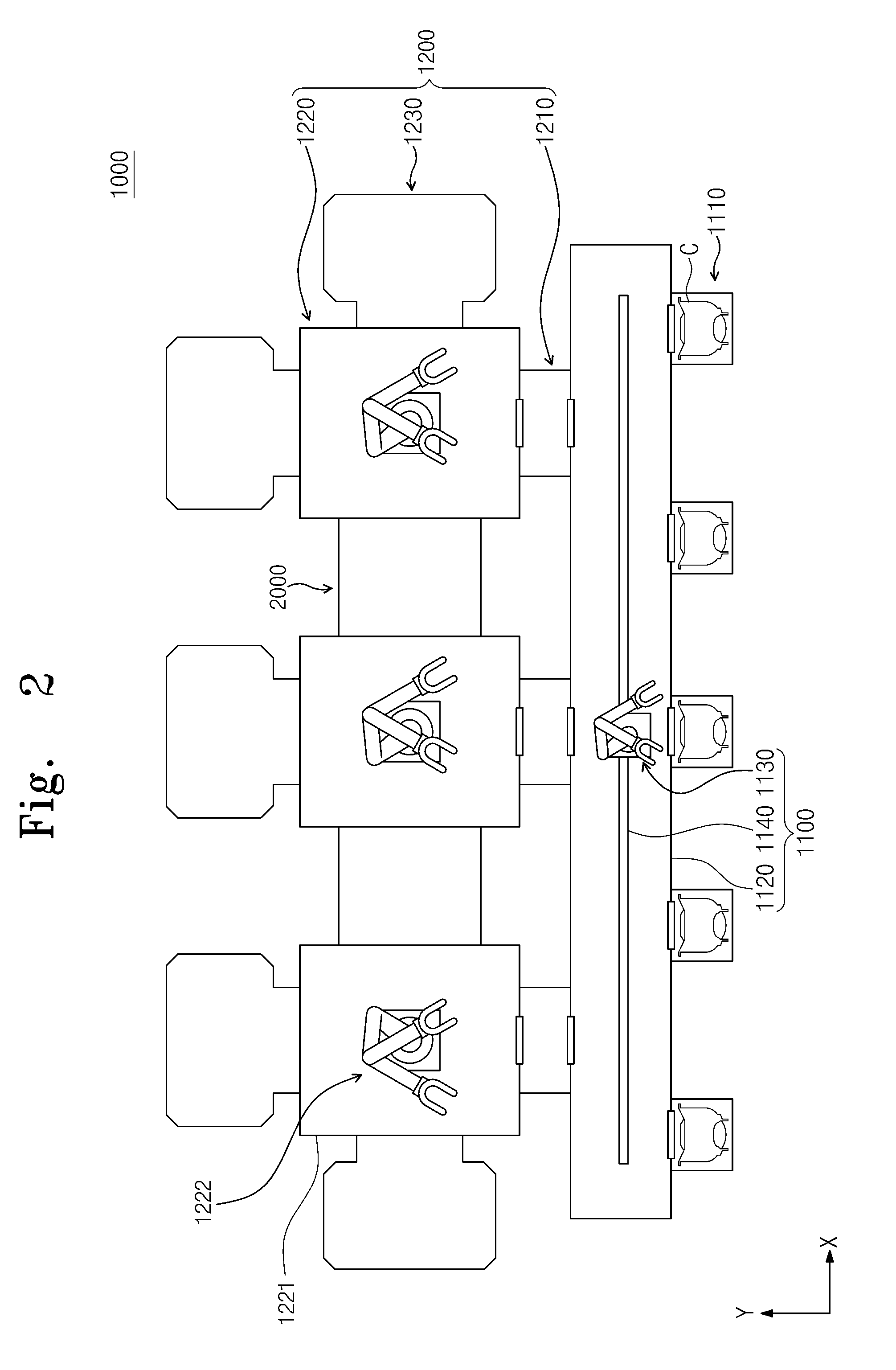

A processing system includes process modules, load lock modules, an equipment controller, and a machine controller. The equipment controller controls transfer and processing of wafers in the processing system. A transfer destination determining portion determines the transfer destination of each wafer such that each wafer is sequentially transferred to a normally operating process module. When an abnormality occurs in a process module, an evacuation portion temporarily evacuates to a cassette stage the wafer determined is to be transferred to the abnormal process module and that has not yet been transferred to the abnormal process module. When a new transfer destination of the evacuated wafer is determined, if a process that is performed immediately before processing the evacuated wafer in the processing module as the new transfer destination satisfies a predetermined condition, a transfer inhibition portion inhibits the transfer of the evacuated wafer to the new transfer destination.

Owner:TOKYO ELECTRON LTD

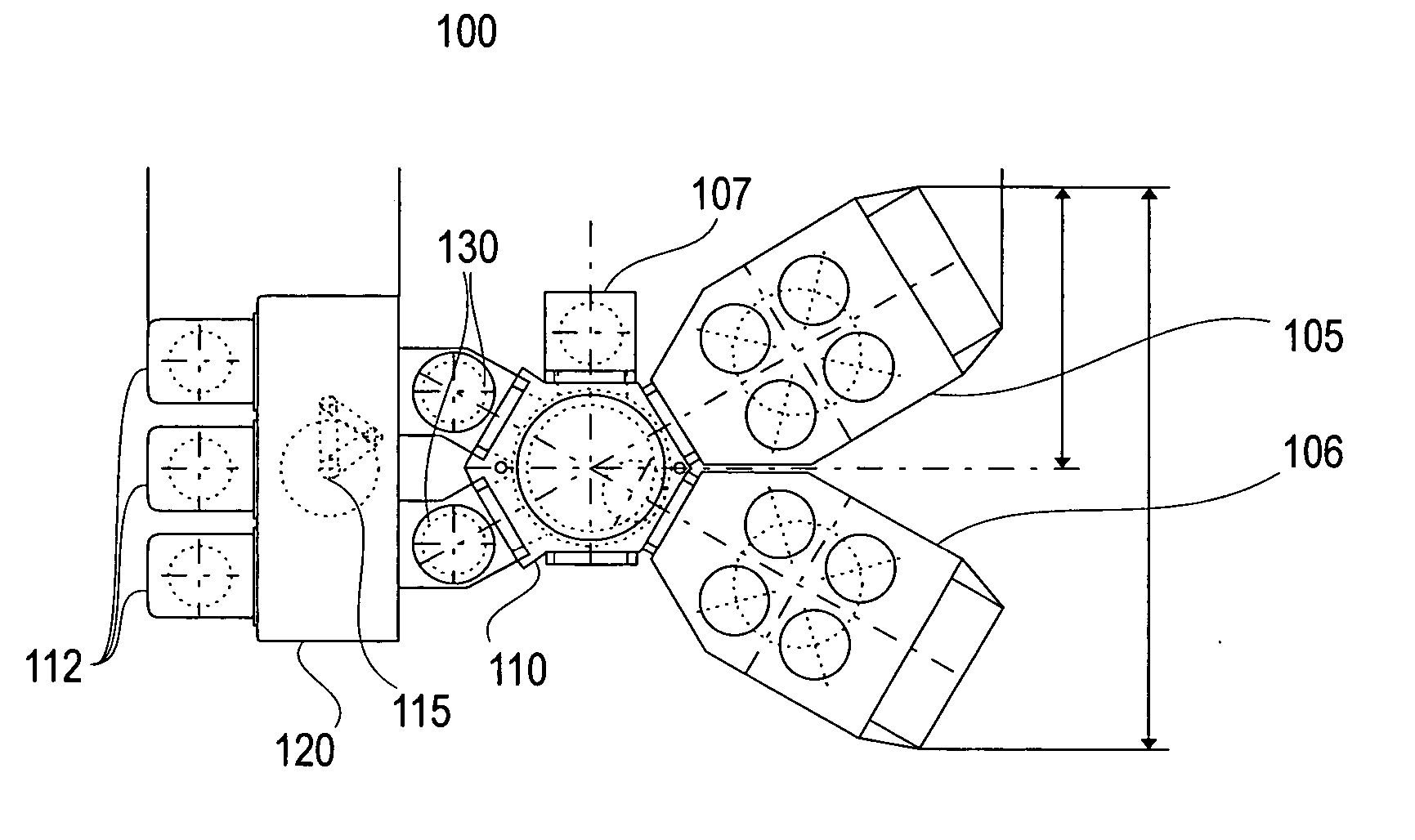

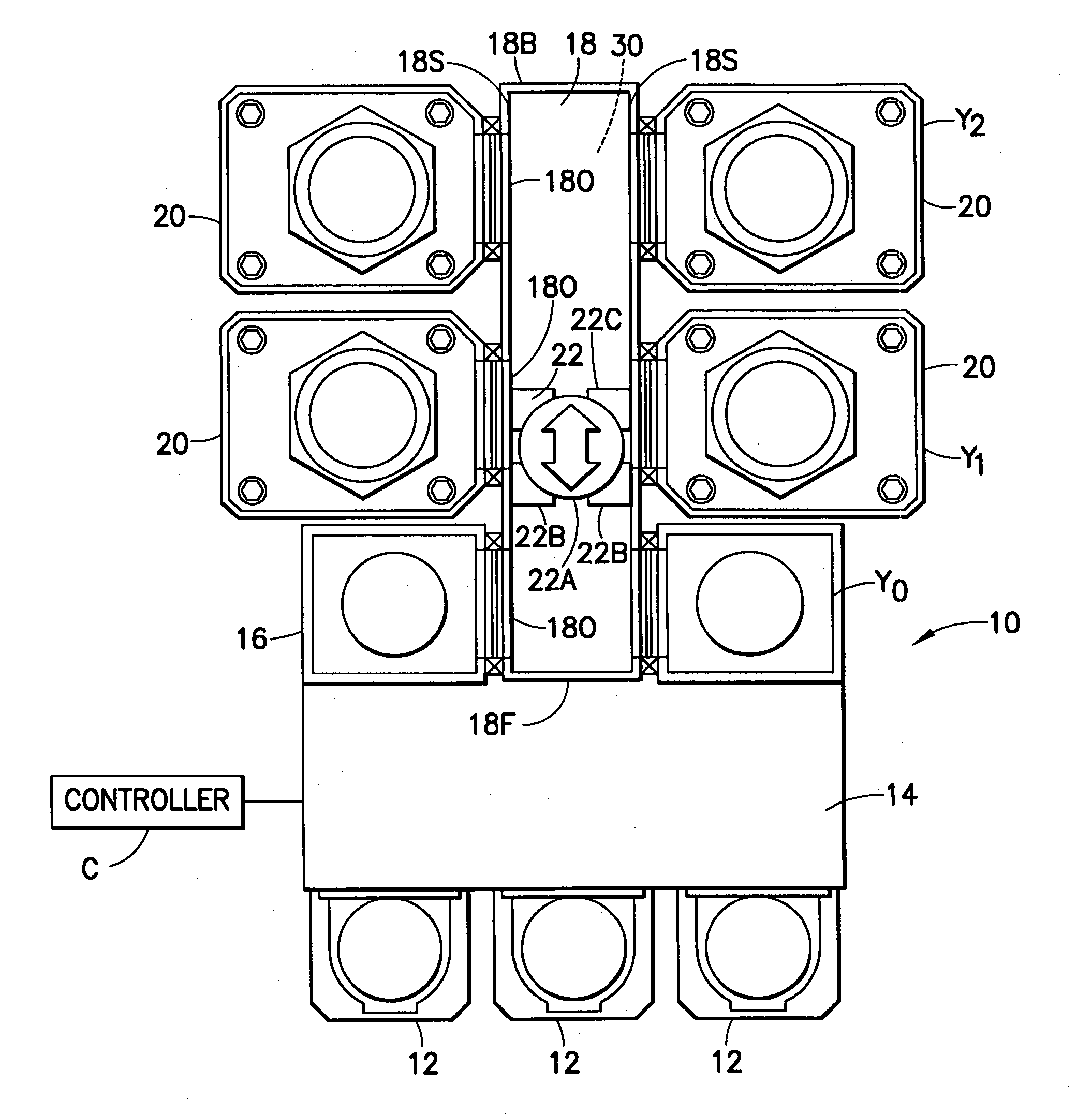

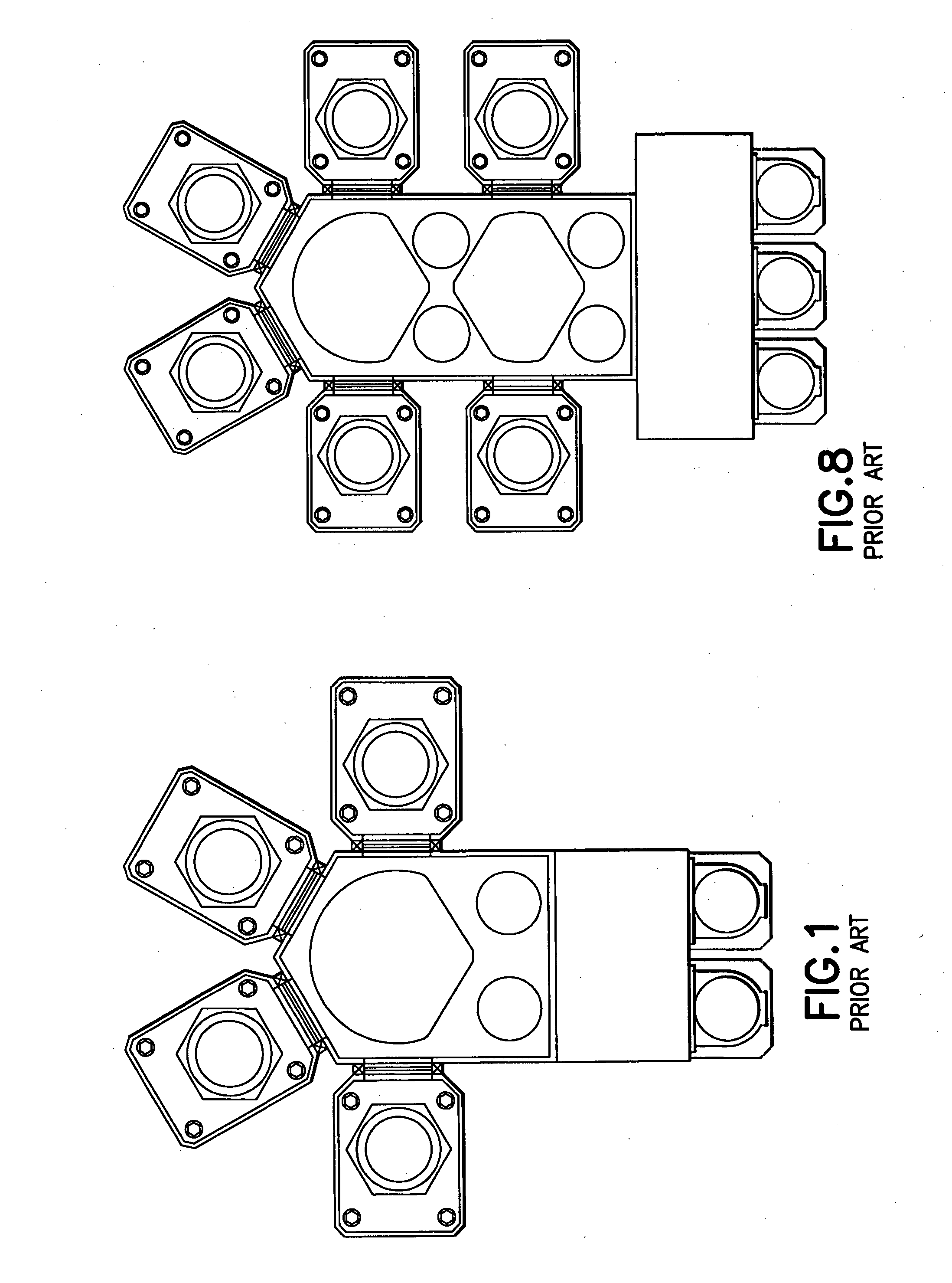

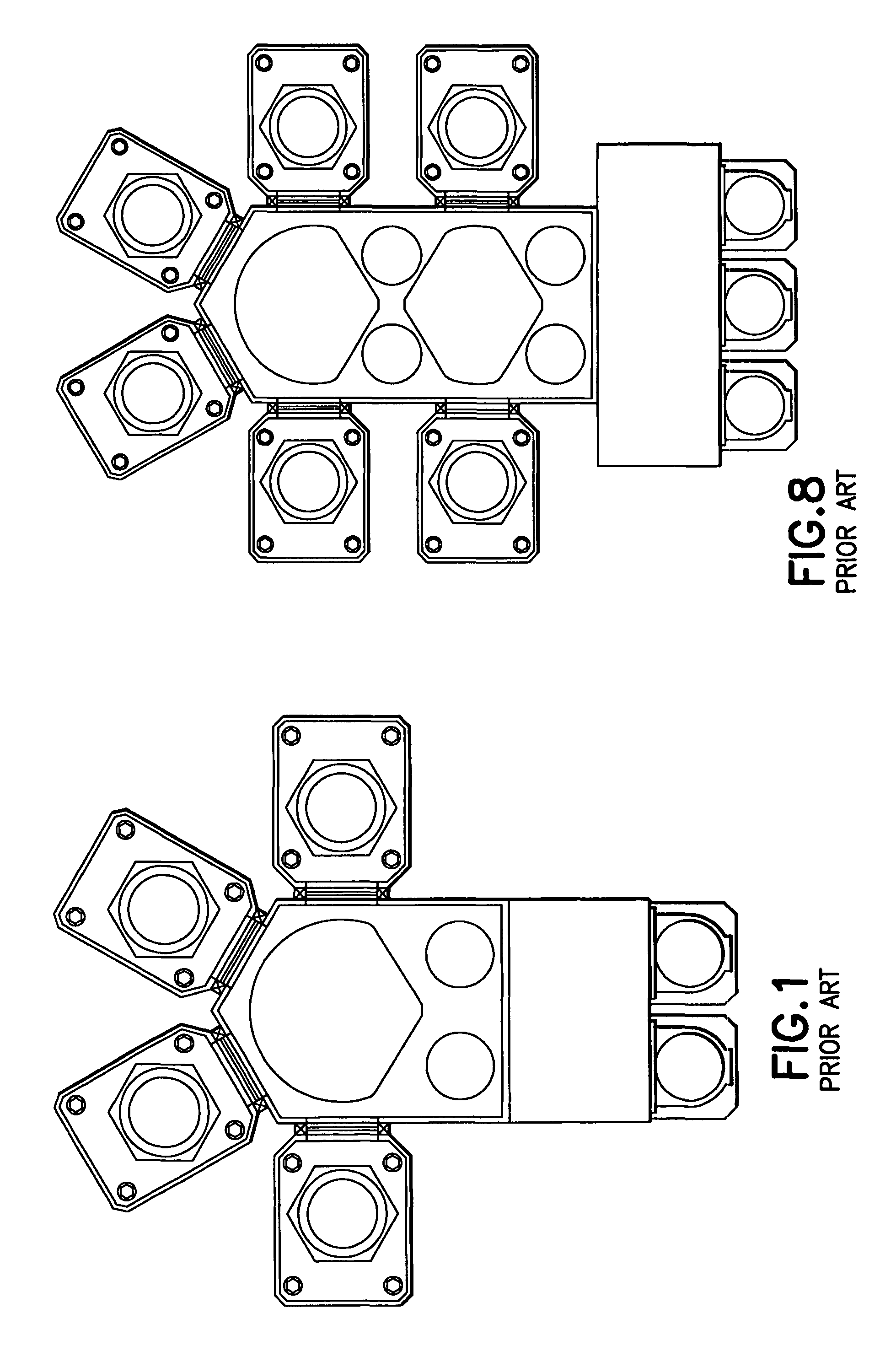

Semiconductor manufacturing process modules

ActiveUS20080124197A1Balance processing loadSemiconductor/solid-state device manufacturingConveyor partsProcess moduleSemiconductor

Owner:BOOKS AUTOMATION US LLC

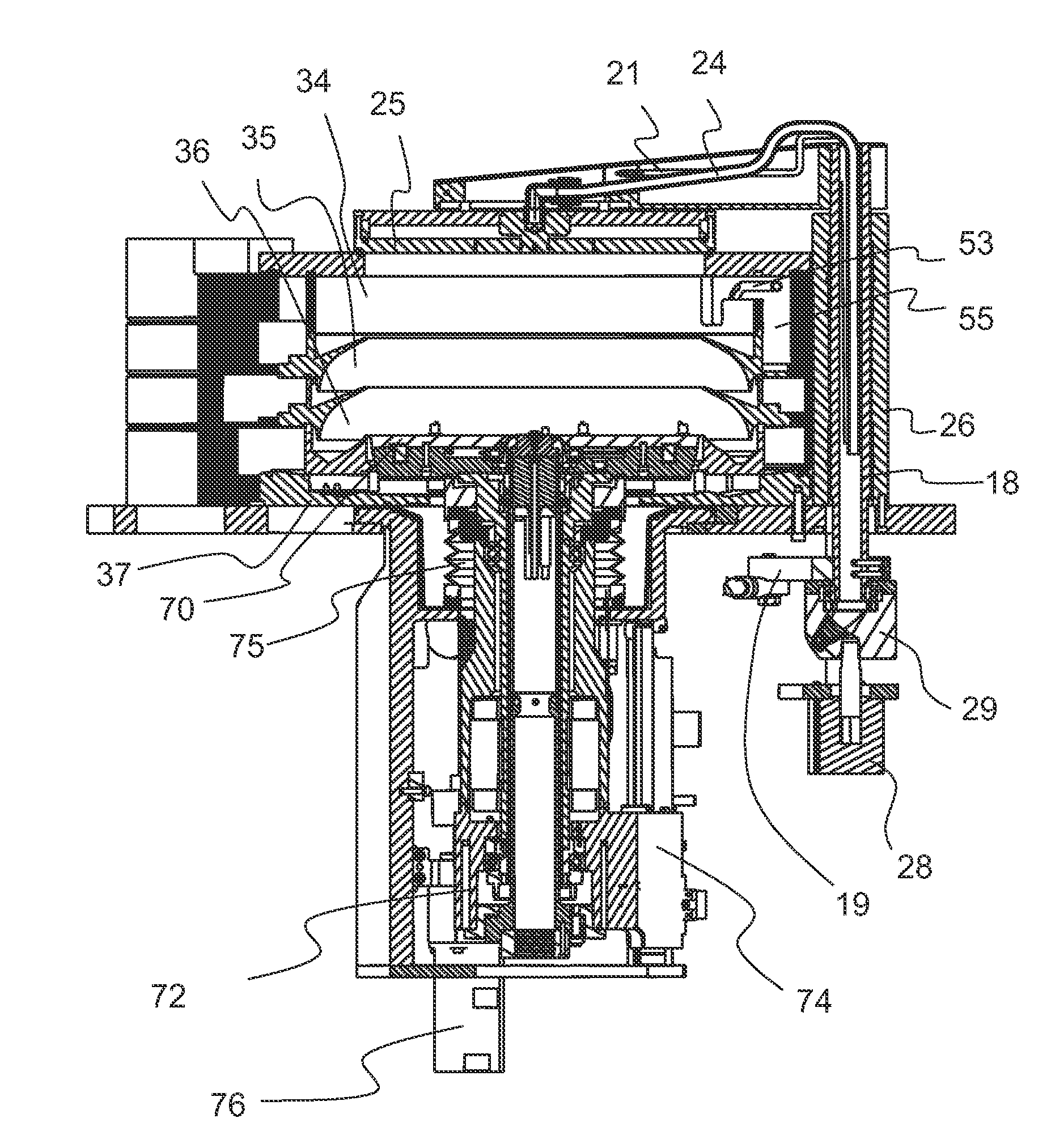

Atomic layer deposition apparatus

ActiveUS20100186669A1Avoid time delayShorten the timeSemiconductor/solid-state device manufacturingChemical vapor deposition coatingProcess moduleEngineering

An atomic deposition apparatus is provided for simultaneously loading / unloading a plurality of substrates. The atomic deposition apparatus which may load / unload the plurality of substrates when transmitting the plurality of substrates to a process module, includes a loading / unloading module for loading / unloading a substrate, a process module including a plurality of process chambers for simultaneously receiving a plurality of substrates and performing a deposition process, each of the plurality of process chambers including a gas spraying unit having an exhaust portion by which an exhaust gas is drawn in from inside the process chamber and the drawn in gas is exhausted above the process chamber, and a transfer module including a transfer robot provided between the loading / unloading module and the process module, the transfer robot being adopted for simultaneously holding the plurality of substrates while transporting the substrate.

Owner:K C TECH

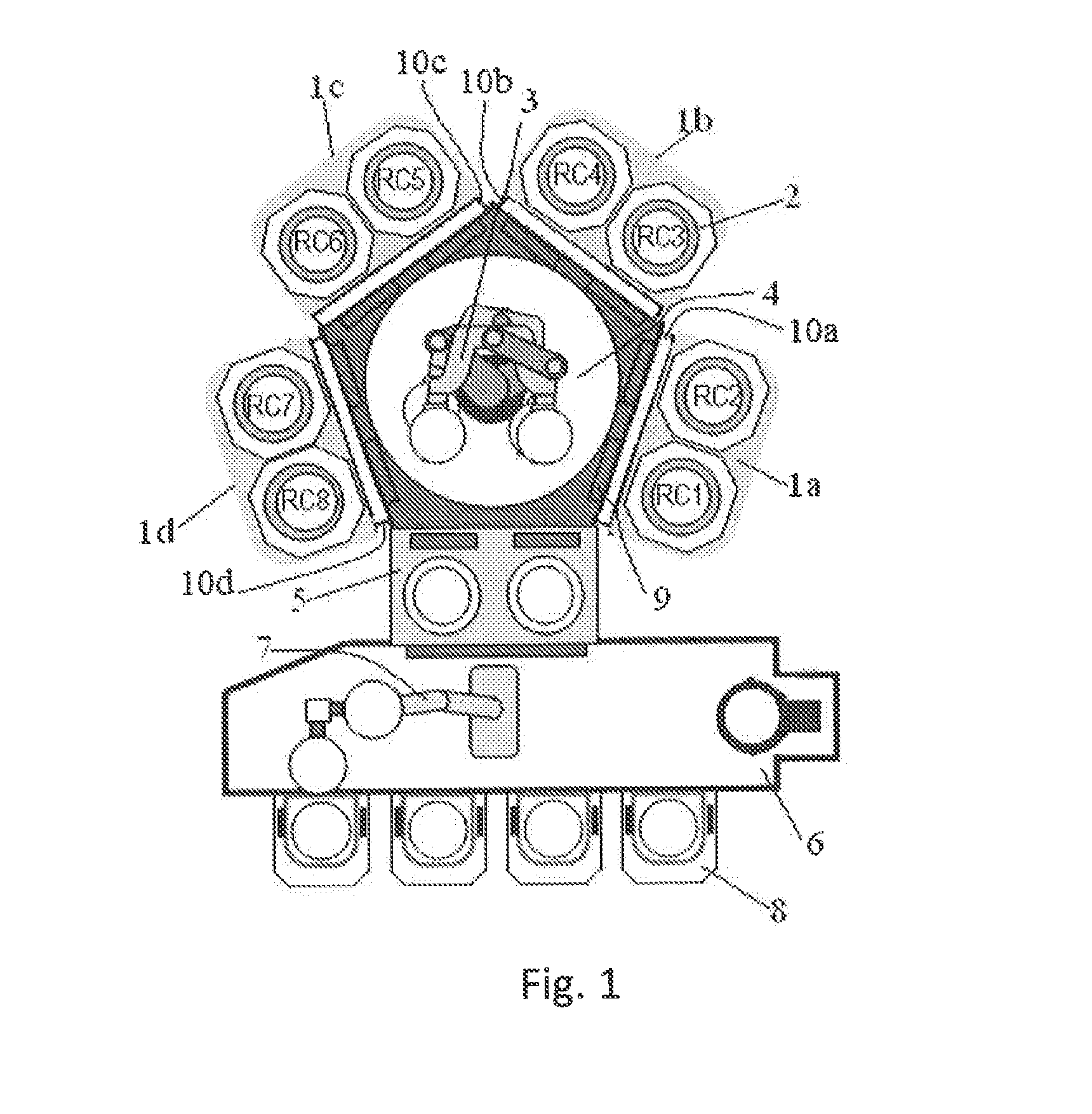

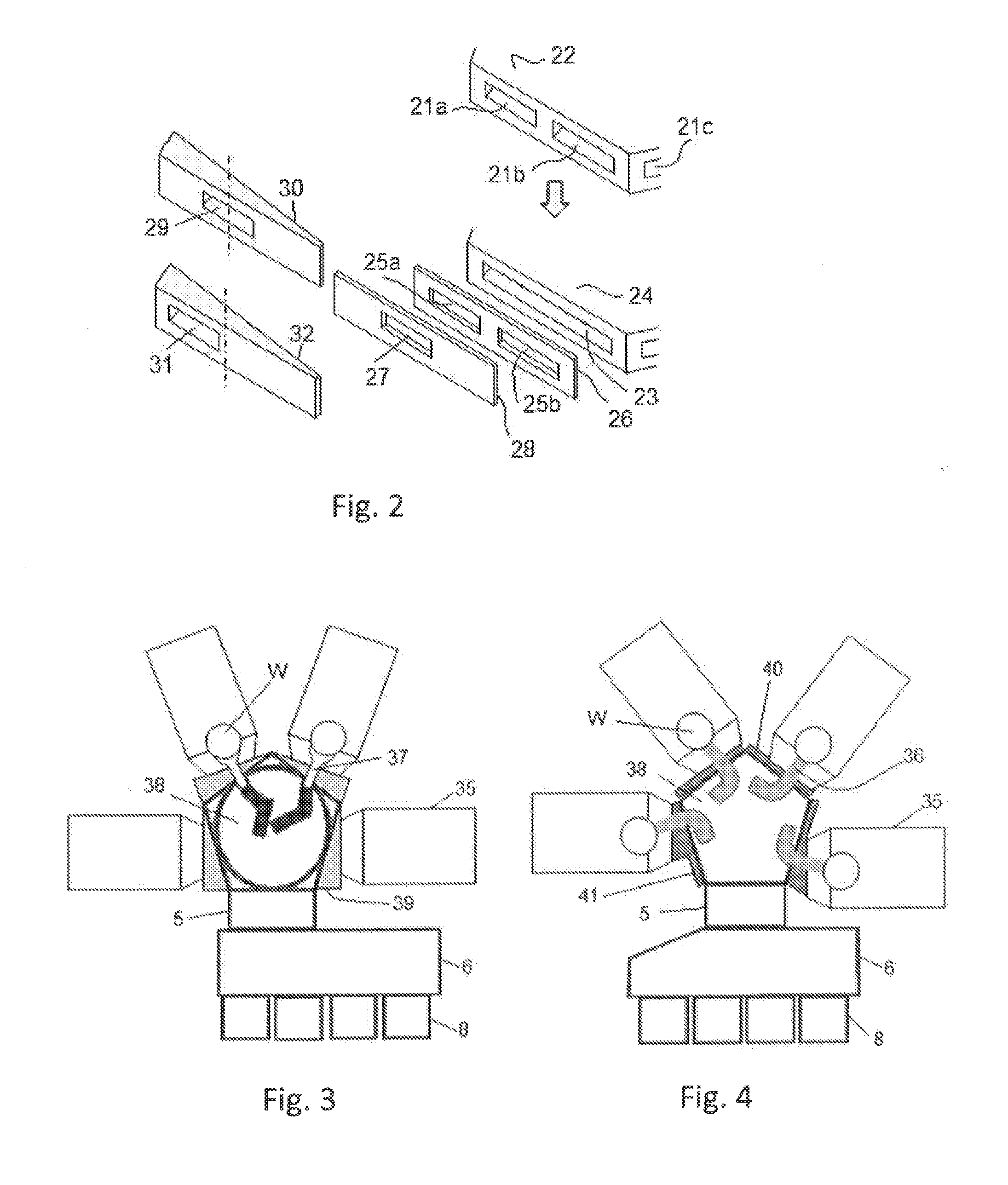

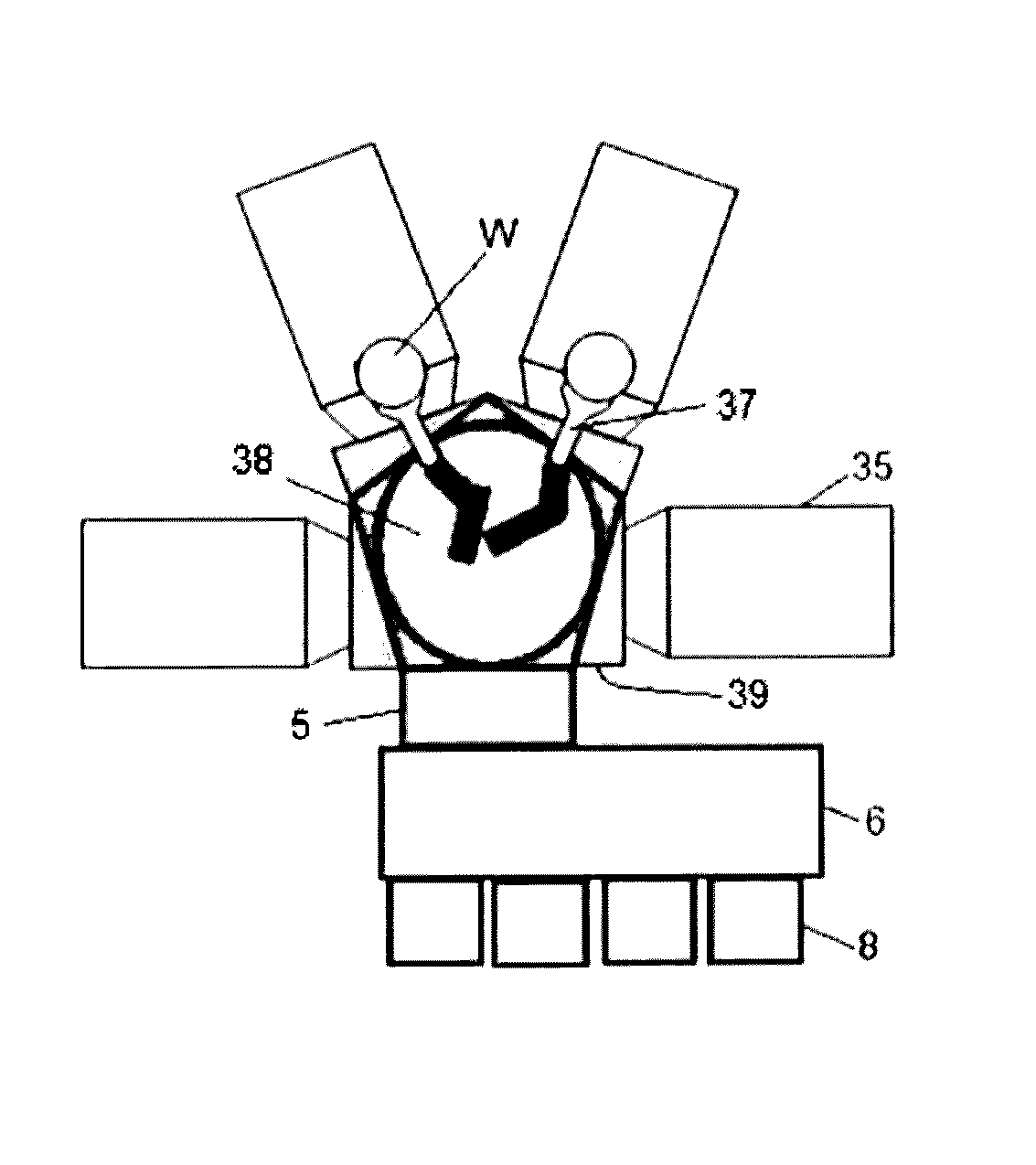

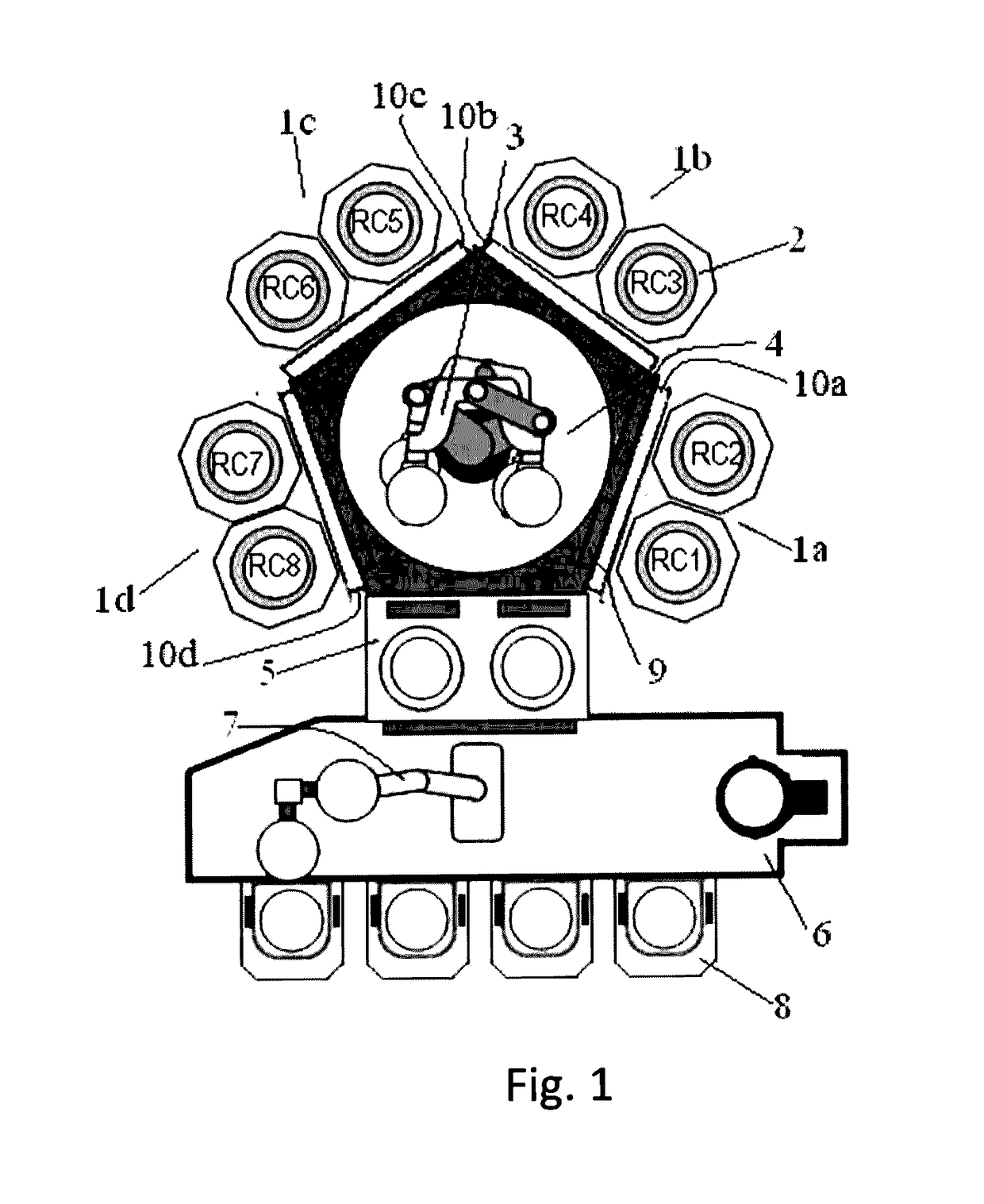

Multi-single wafer processing apparatus

InactiveUS20060137609A1Semiconductor/solid-state device manufacturingChemical vapor deposition coatingProcess moduleEngineering

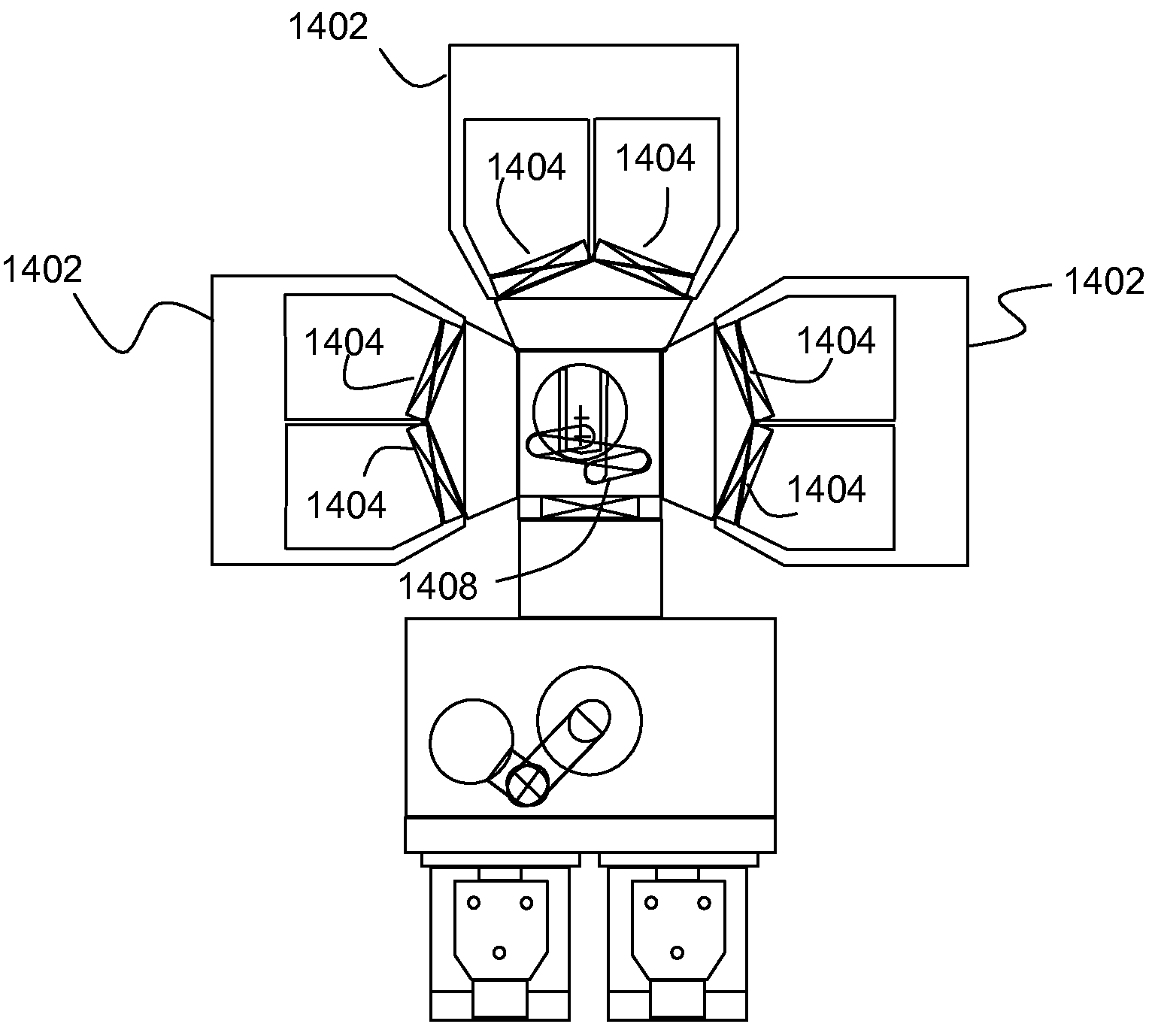

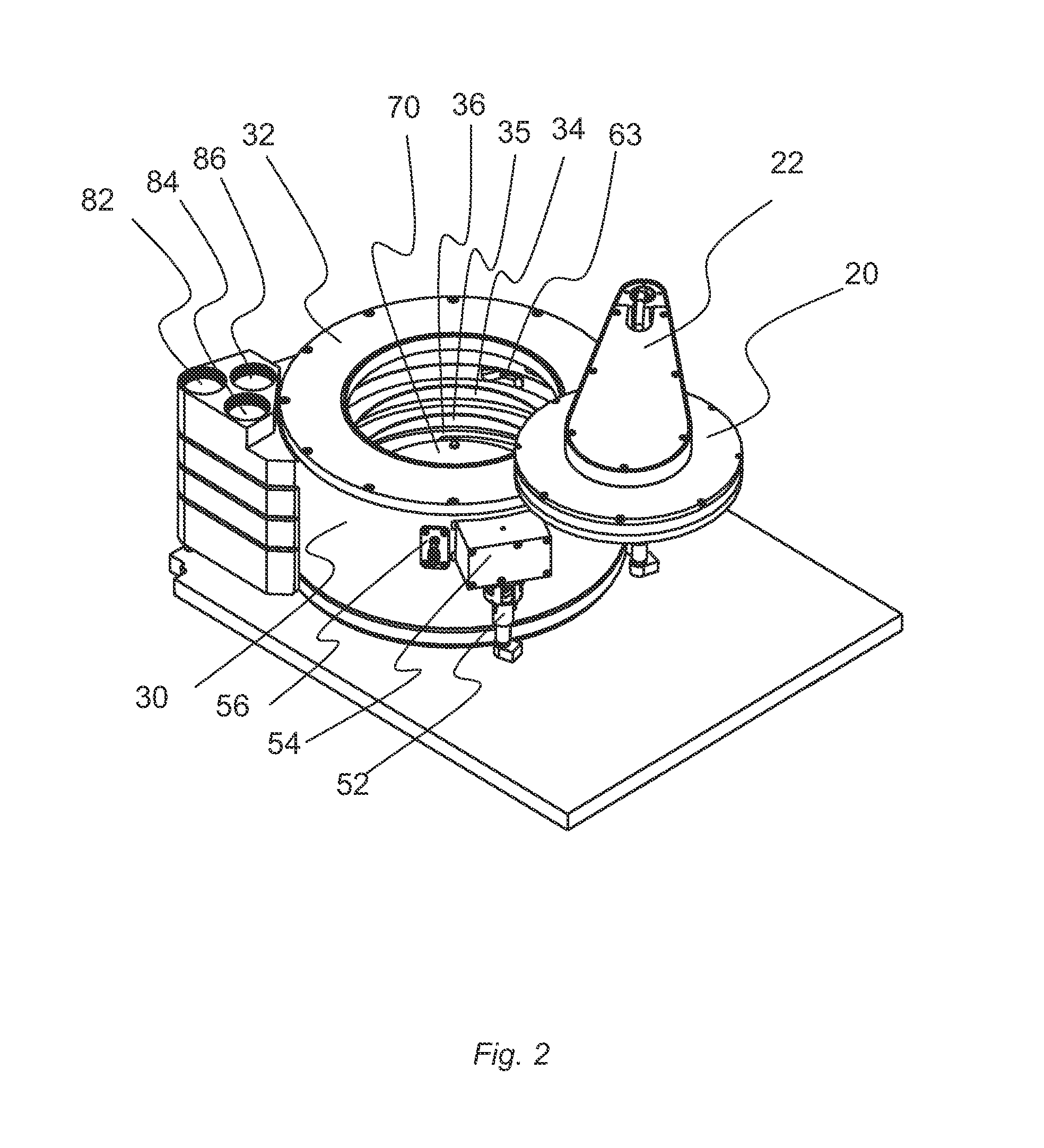

A wafer processing apparatus includes one or more processing modules, each having multiple, distinct, single-wafer processing reactors configured for semi-independent ALD and / or CVD film deposition therein; a robotic central wafer handler configured to provide wafers to and accept wafers from each of said wafer processing modules; and a single-wafer loading and unloading mechanism that includes a loading and unloading port and a mini-environment coupling the loading and unloading port to the robotic central wafer handler. The wafer processing reactors may be arranged (i) along axes of a Cartesian coordinate system, or (ii) in quadrants defined by said axes, one axis being parallel to a wafer input plane of the at least one of the process modules to which the single-wafer processing reactors belong. Each processing module can include up to four single-wafer processing reactors, each with an independent gas distribution module.

Owner:AIXTRON INC

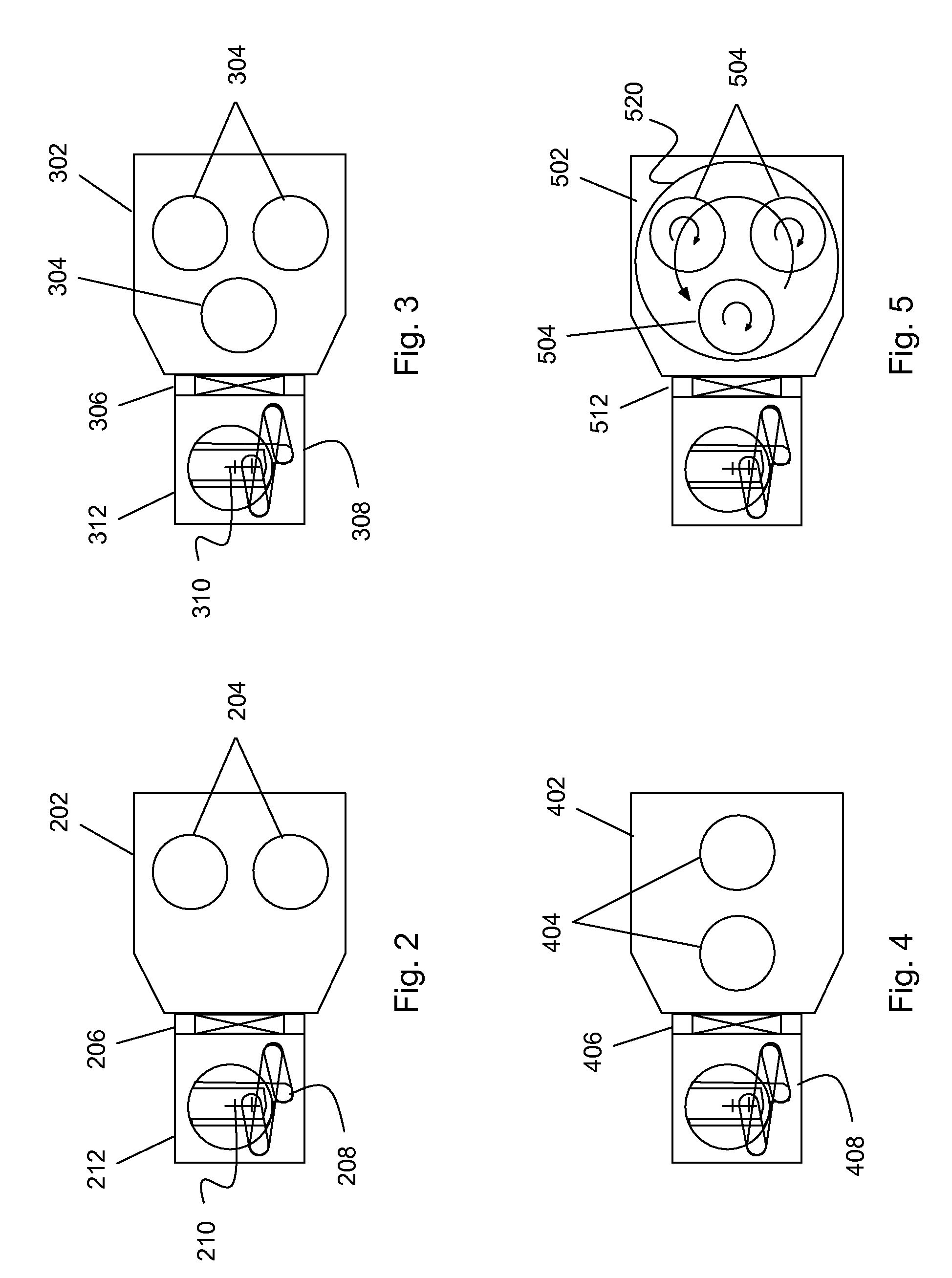

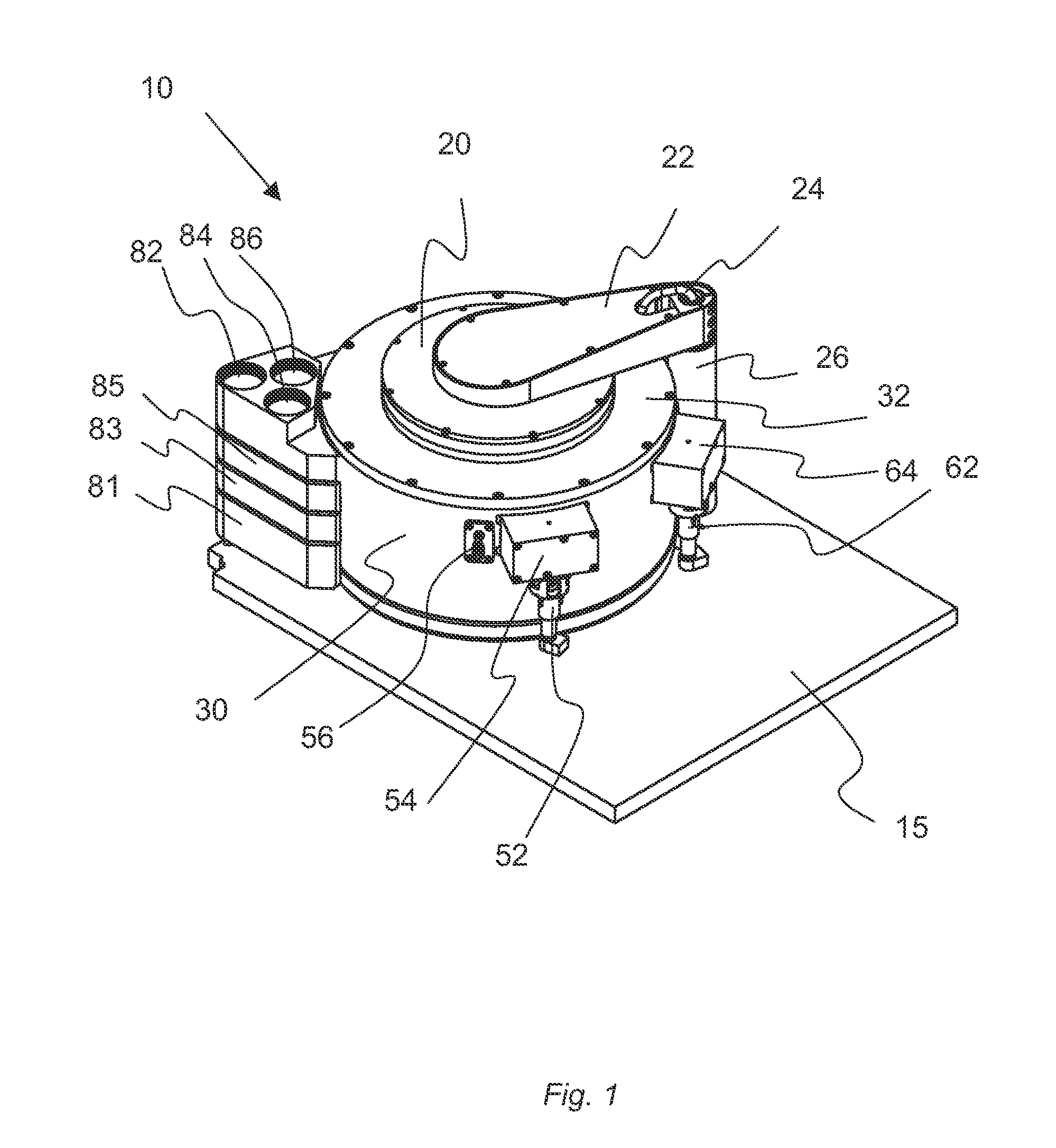

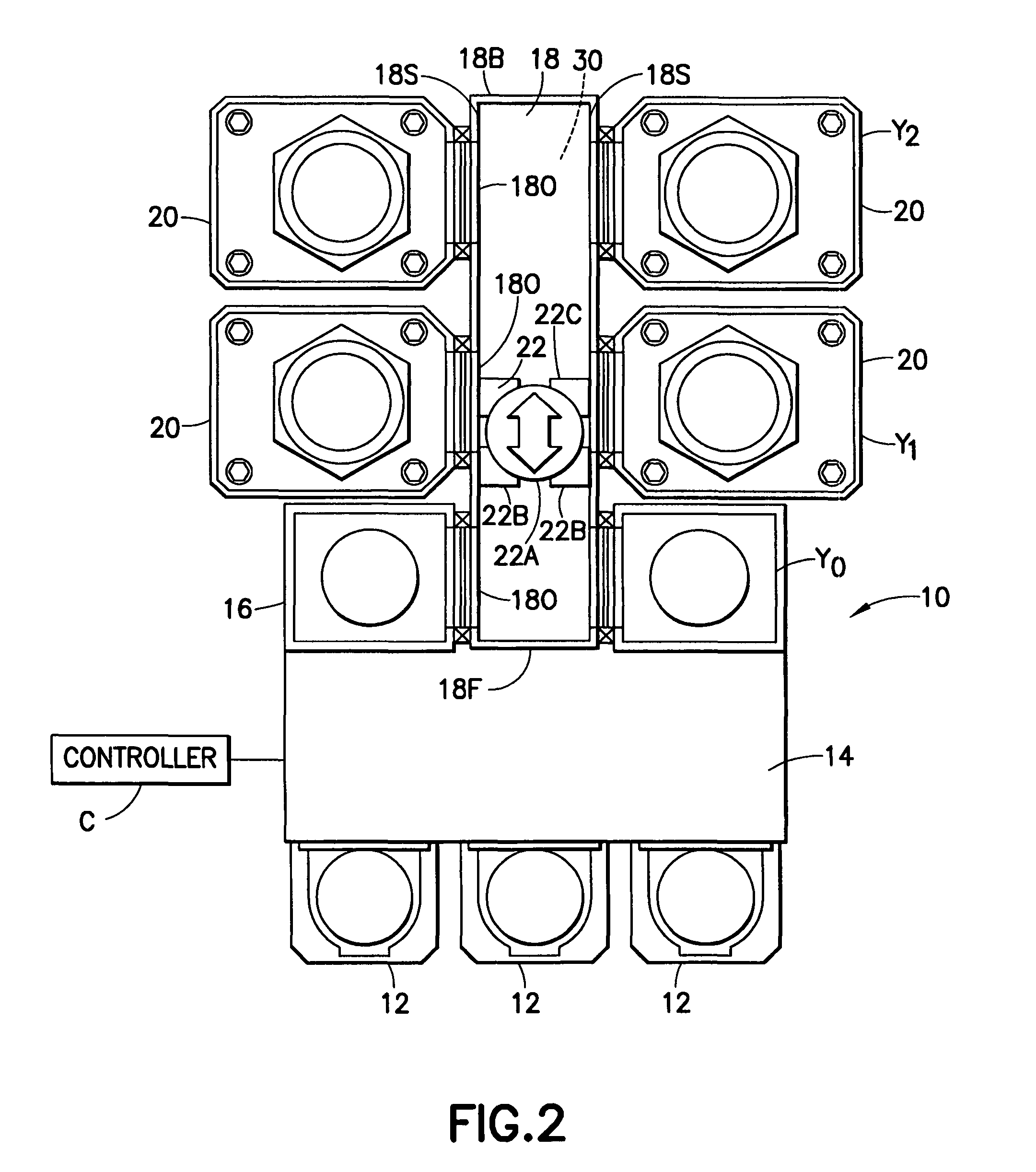

Single-and dual-chamber module-attachable wafer-handling chamber

ActiveUS20140174354A1Increased Design FreedomLiquid surface applicatorsSemiconductor/solid-state device manufacturingBiochemical engineeringProcess module

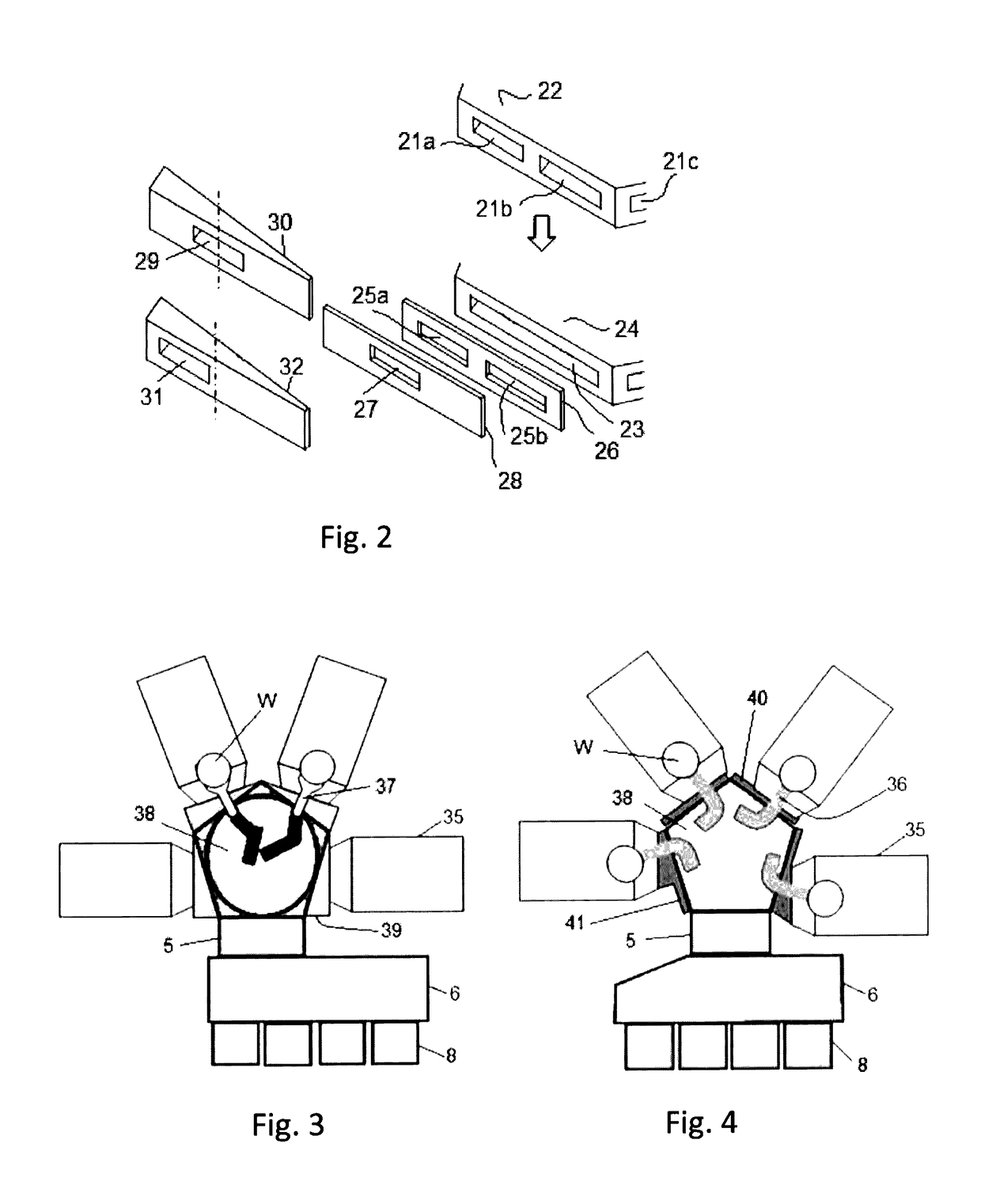

A single- and dual-chamber module-attachable wafer-handling chamber includes: a wafer-handling main chamber equipped with a wafer-handling robot therein, and adaptors for connecting process modules to the wafer-handling main chamber. The adaptors are detachably attached to the sides of the wafer-handling main chamber, respectively, and the process modules are detachably attached to the adaptors, respectively, so that the process modules can be attached to the wafer-handling main chamber, regardless of whether the process modules are of a single-chamber type or dual-chamber type.

Owner:ASM IP HLDG BV

Single-and dual-chamber module-attachable wafer-handling chamber

ActiveUS9640416B2Increased Design FreedomSemiconductor/solid-state device manufacturingRobotProcess moduleBiochemical engineering

A single- and dual-chamber module-attachable wafer-handling chamber includes: a wafer-handling main chamber equipped with a wafer-handling robot therein, and adaptors for connecting process modules to the wafer-handling main chamber. The adaptors are detachably attached to the sides of the wafer-handling main chamber, respectively, and the process modules are detachably attached to the adaptors, respectively, so that the process modules can be attached to the wafer-handling main chamber, regardless of whether the process modules are of a single-chamber type or dual-chamber type.

Owner:ASM IP HLDG BV

Method and apparatus for histological and physiological biometric operation and authentication

InactiveUS6483929B1Improve securityLow profileElectric signal transmission systemsImage analysisProcess moduleComputer science

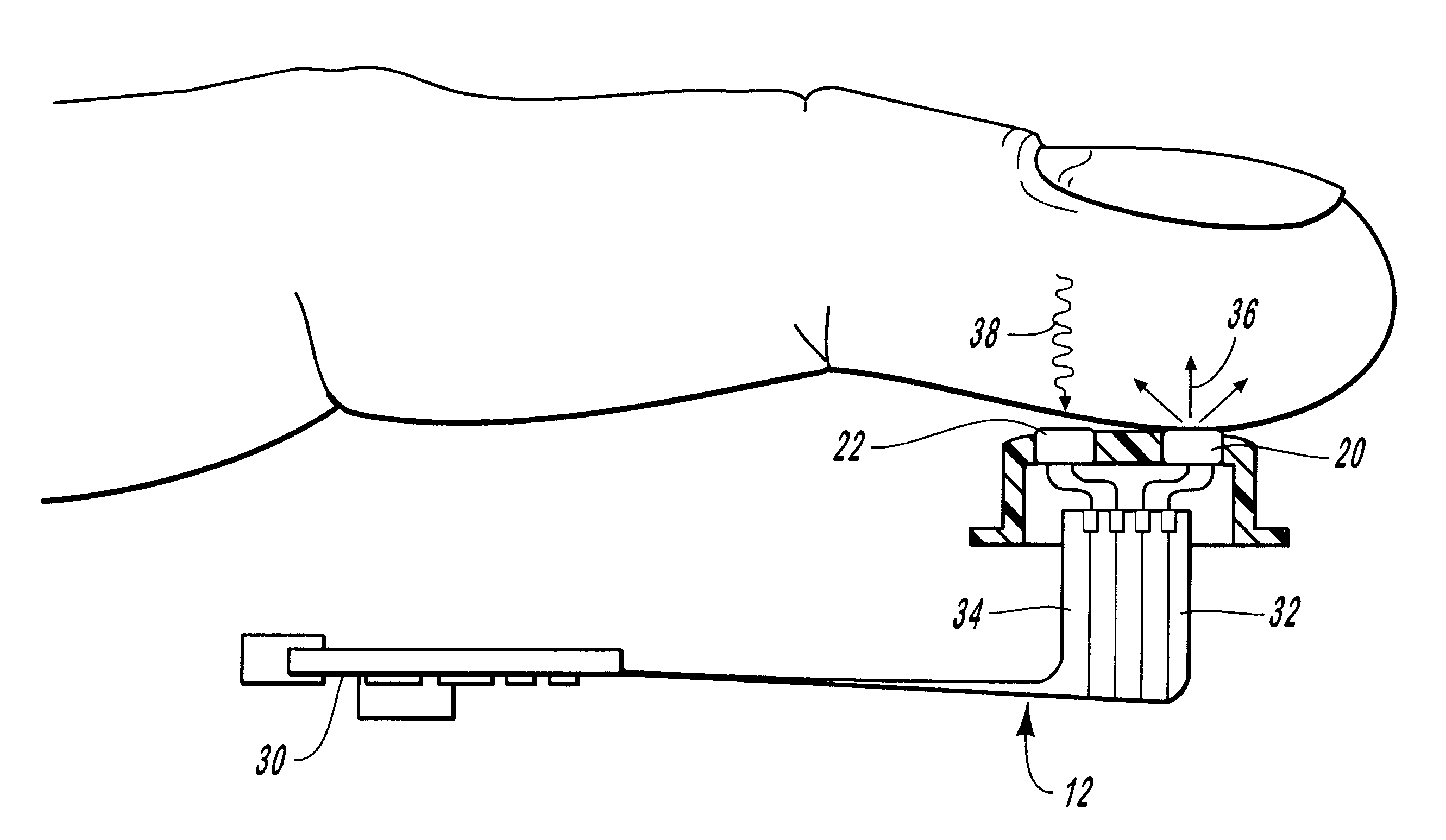

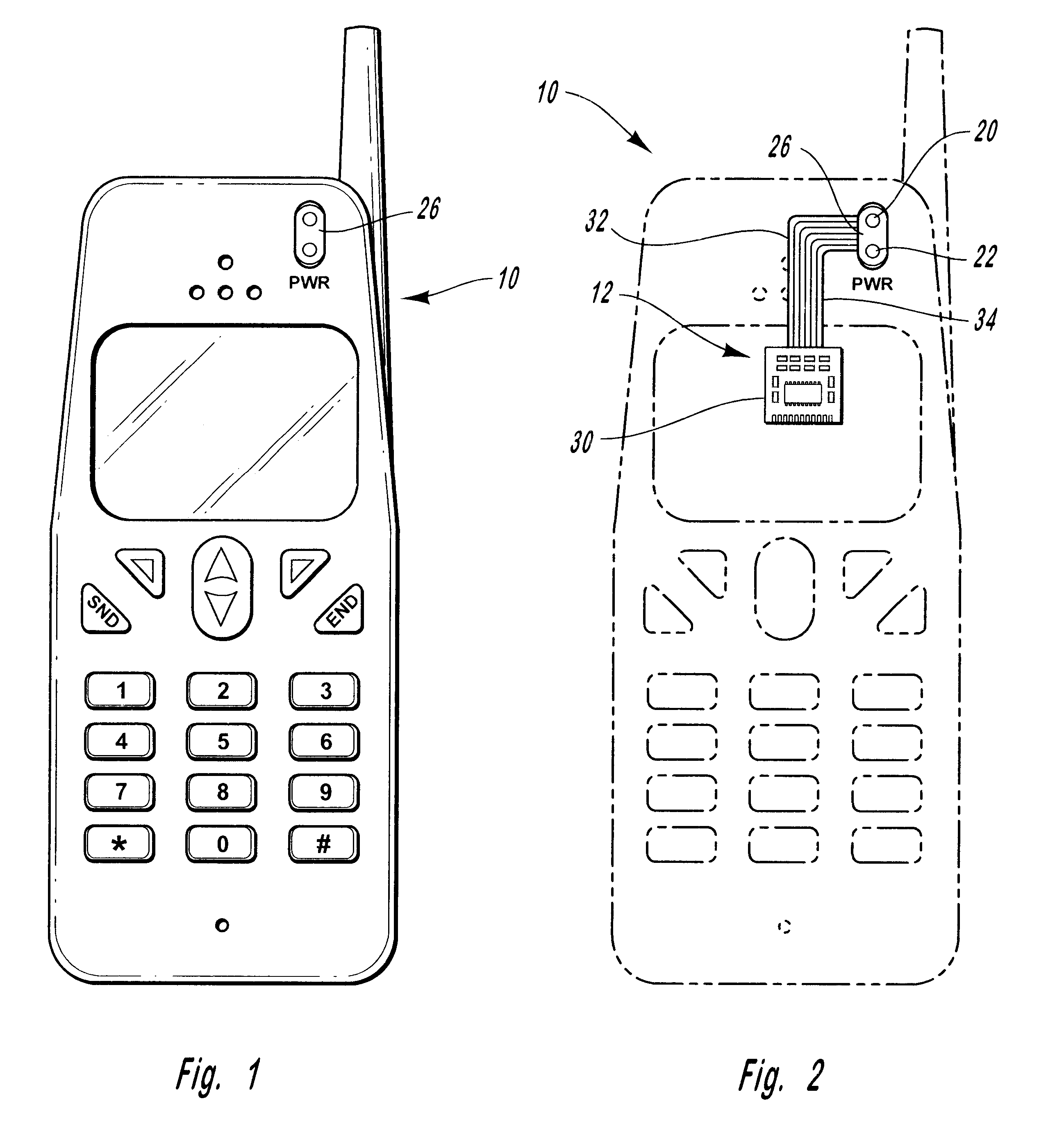

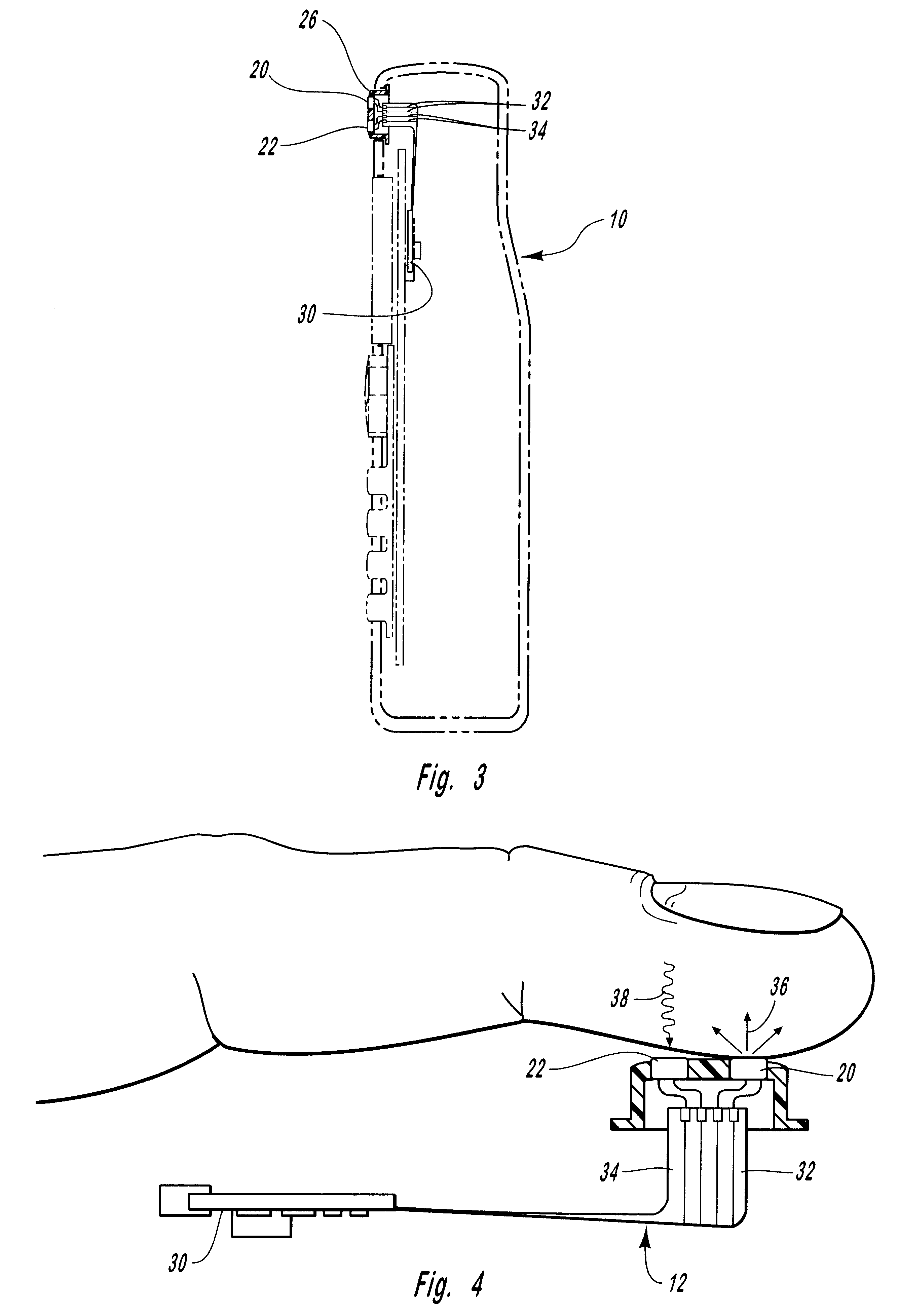

The present invention is directed toward a device for biometric authentication. The device comprises an infra red signal transmitter, signal receiver, memory module, and processing module. The signal transmitter transmits infrared energy toward a user. The infrared energy is partly absorbed and partly reflected by the user's body. The infra red signal receiver collects partly reflected infrared energy. The memory module stores the data, and the processing module processes and compares the reflected infrared energy and stored data for use in biometric authentication.

Owner:HALO WEARABLES LLC

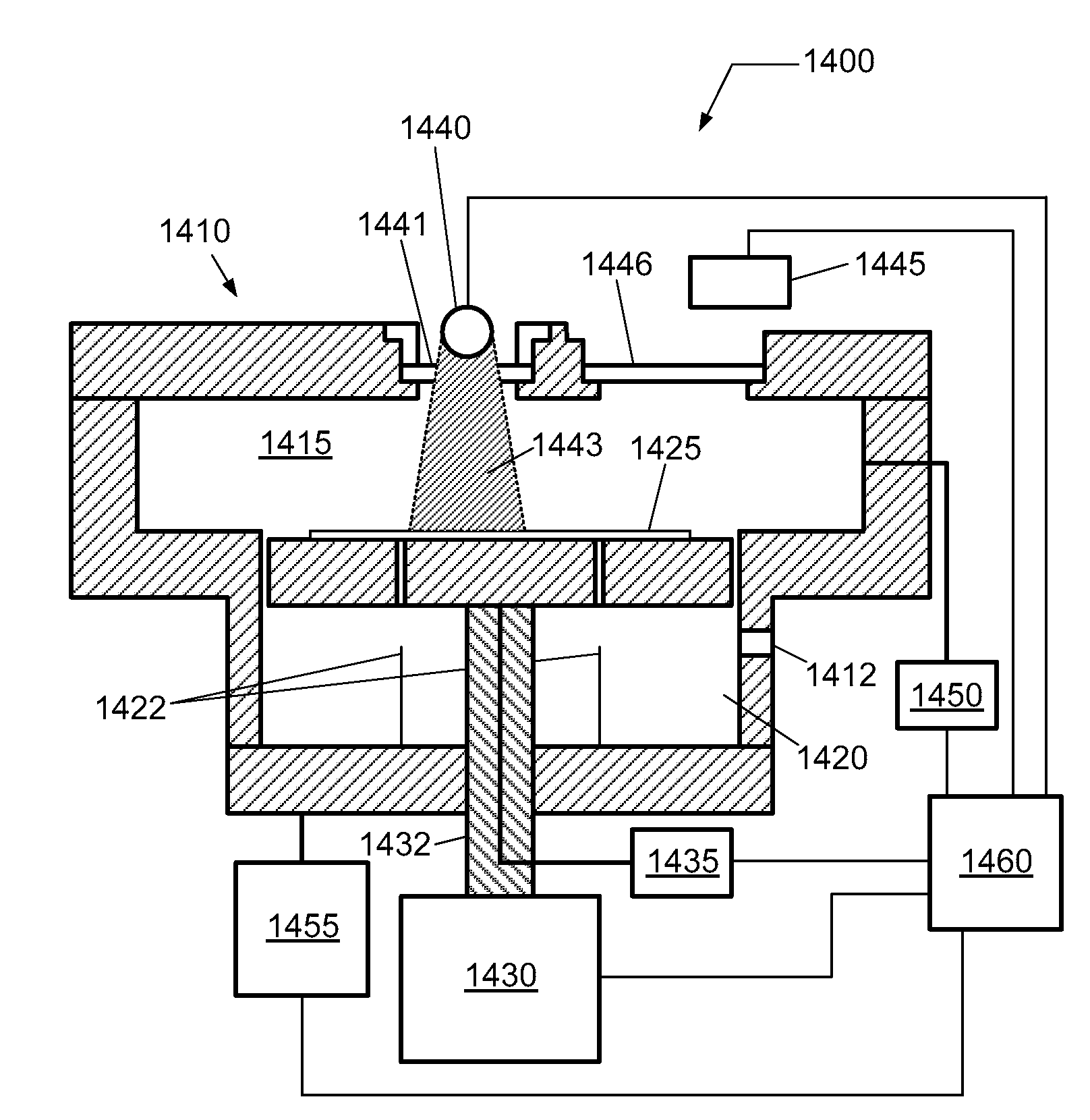

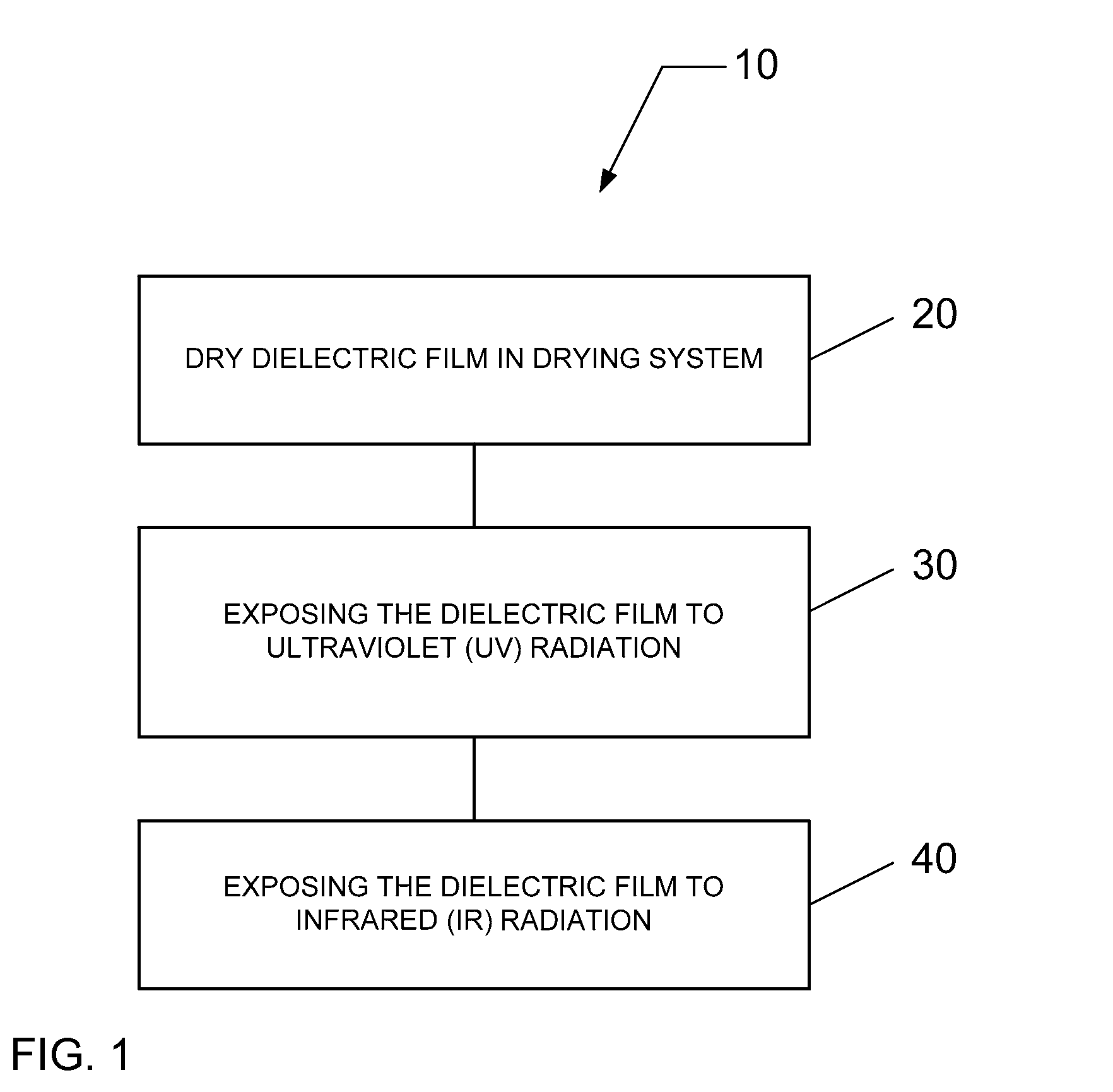

Dielectric material treatment system and method of operating

InactiveUS20100065758A1Semiconductor/solid-state device manufacturingRadiation therapyProcess moduleUltraviolet

A system for curing a low dielectric constant (low-k) dielectric film on a substrate is described, wherein the dielectric constant of the low-k dielectric film is less than a value of approximately 4. The system comprises one or more process modules configured for exposing the low-k dielectric film to electromagnetic (EM) radiation, such as infrared (IR) radiation and ultraviolet (UV) radiation.

Owner:TOKYO ELECTRON LTD

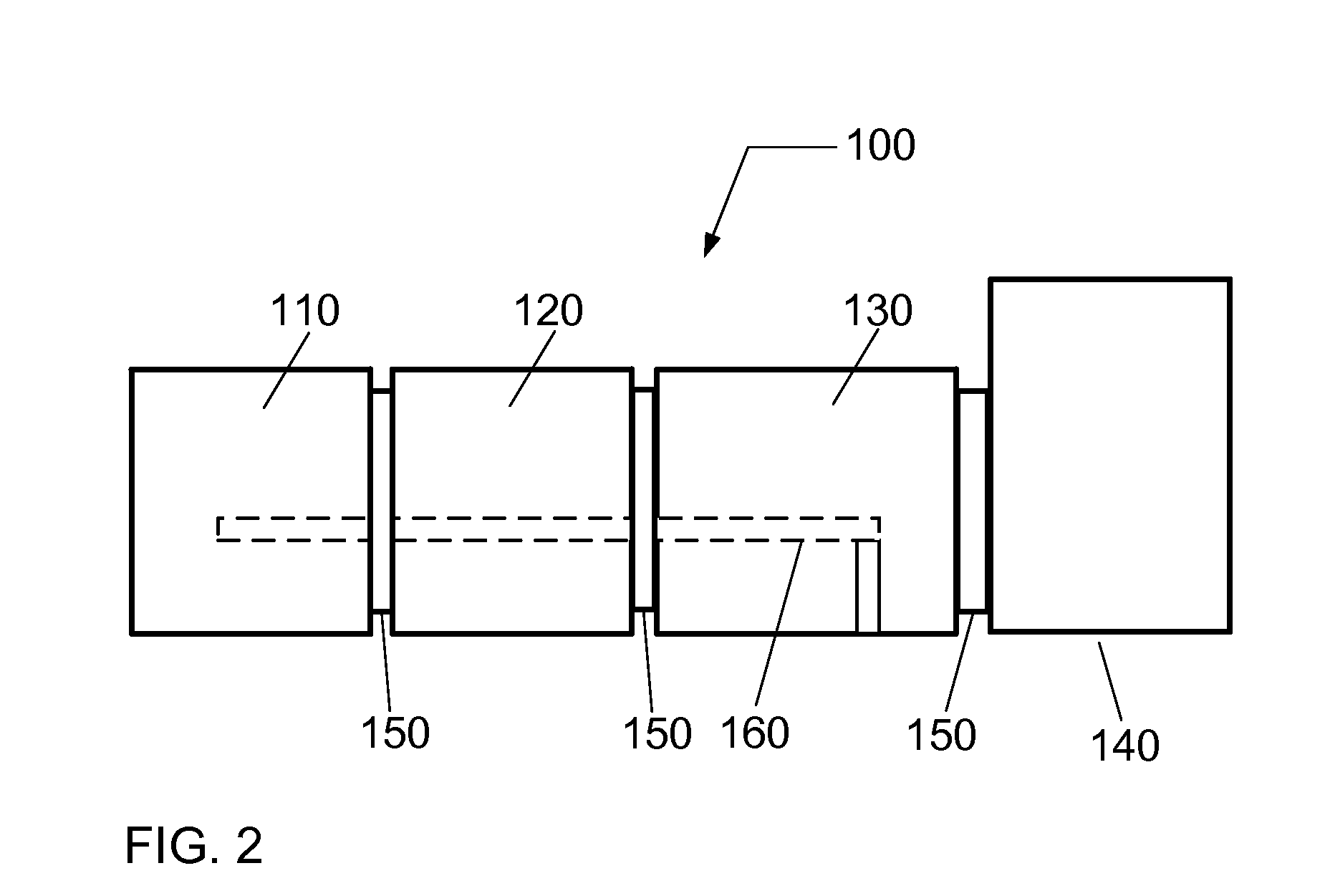

Substrate processing apparatus

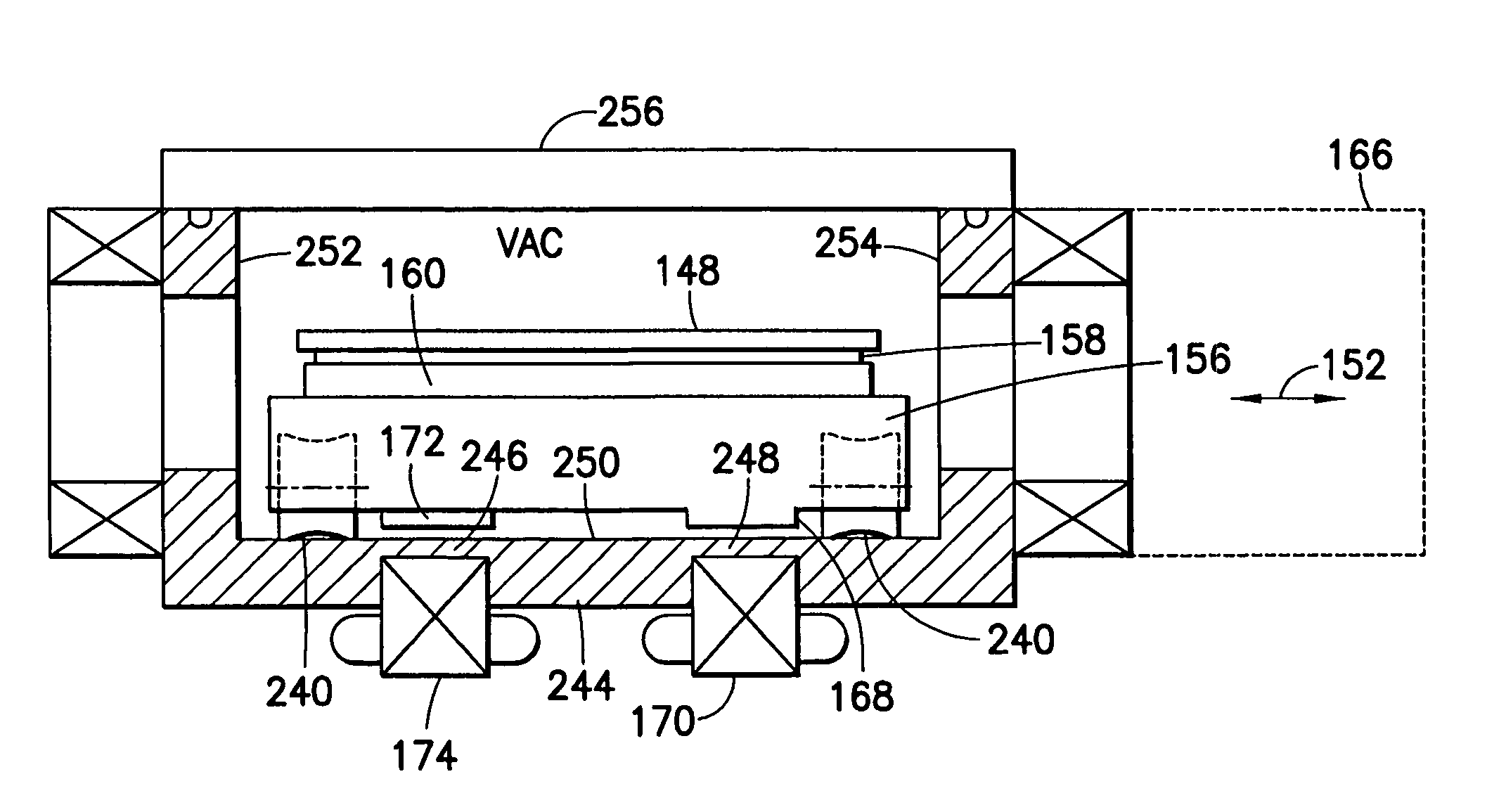

Substrate processing apparatus having a chamber, a generally linear array of process modules, a substrate transport, and a drive system. The chamber is capable of being isolated from the outside atmosphere. Each process module of the array is communicably connected to the chamber to allow a substrate to be transferred between the chamber and process module. The substrate transport is located in and is movably supported from the chamber. The transport is capable of moving along a linear path defined by the chamber for transporting the substrate between process modules. The drive system is connected to the chamber for driving and moving the transport along the linear path. The chamber comprises a selectable number of chamber modules serially abutted to defined the chamber. Each module has an integral portion of the drive system.

Owner:BOOKS AUTOMATION US LLC

Closed chamber for wafer wet processing

ActiveUS20120103522A1Semiconductor/solid-state device manufacturingCleaning using liquidsProcess moduleClosed chamber

An improved design for a closed chamber process module for single wafer wet processing utilizes a combination lid and gas showerhead for sealing the chamber from above. One or more media arms dispense liquid onto a wafer in the chamber. The media arms are mounted inside the chamber but are connected by a linkage that passes through the chamber wall to a drive unit mounted outside the chamber.

Owner:LAM RES AG

Modular parallel-pipelined vision system for real-time video processing

InactiveUS6188381B1Easy to operateReduce control overheadTelevision system detailsColor signal processing circuitsProcess moduleHandling system

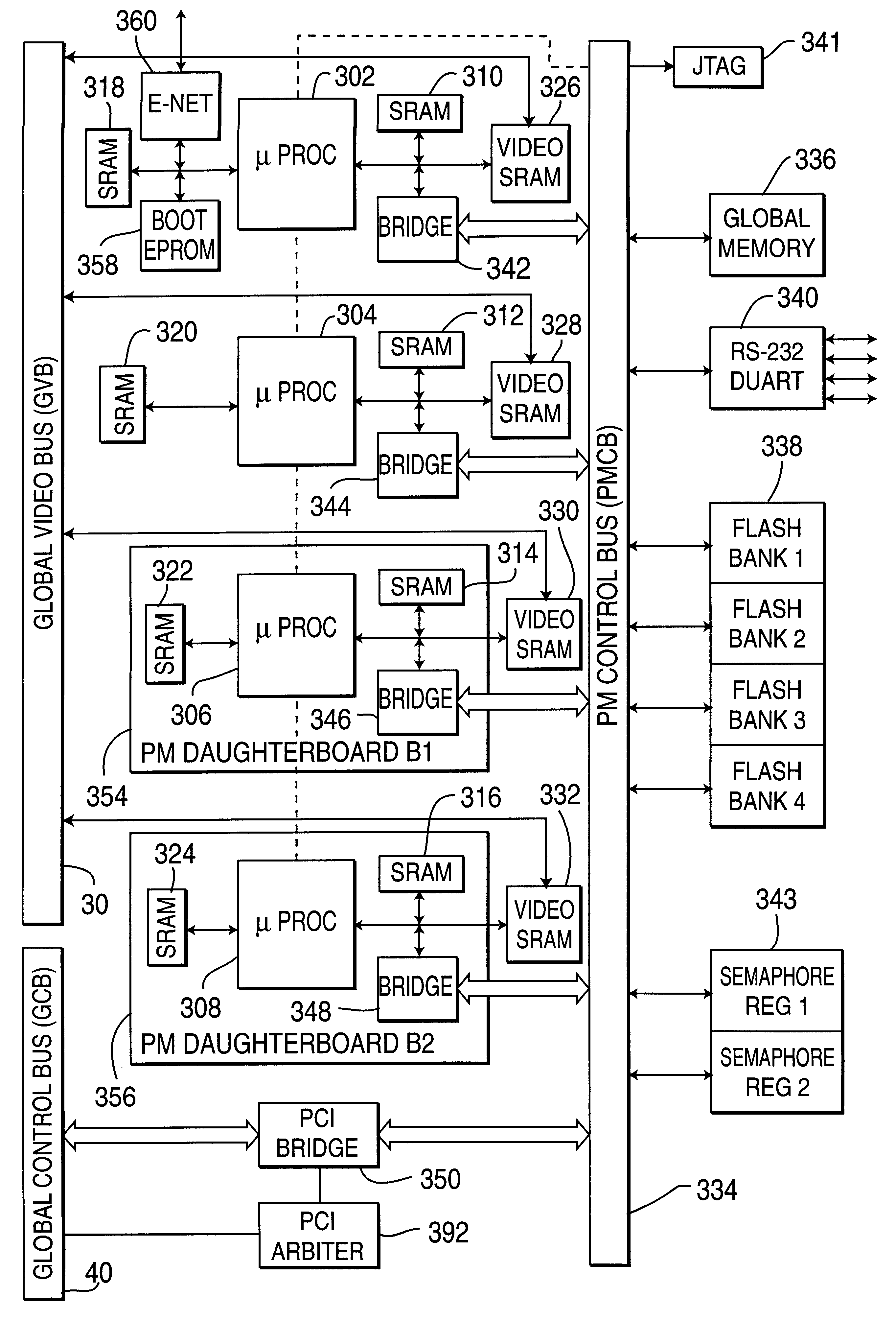

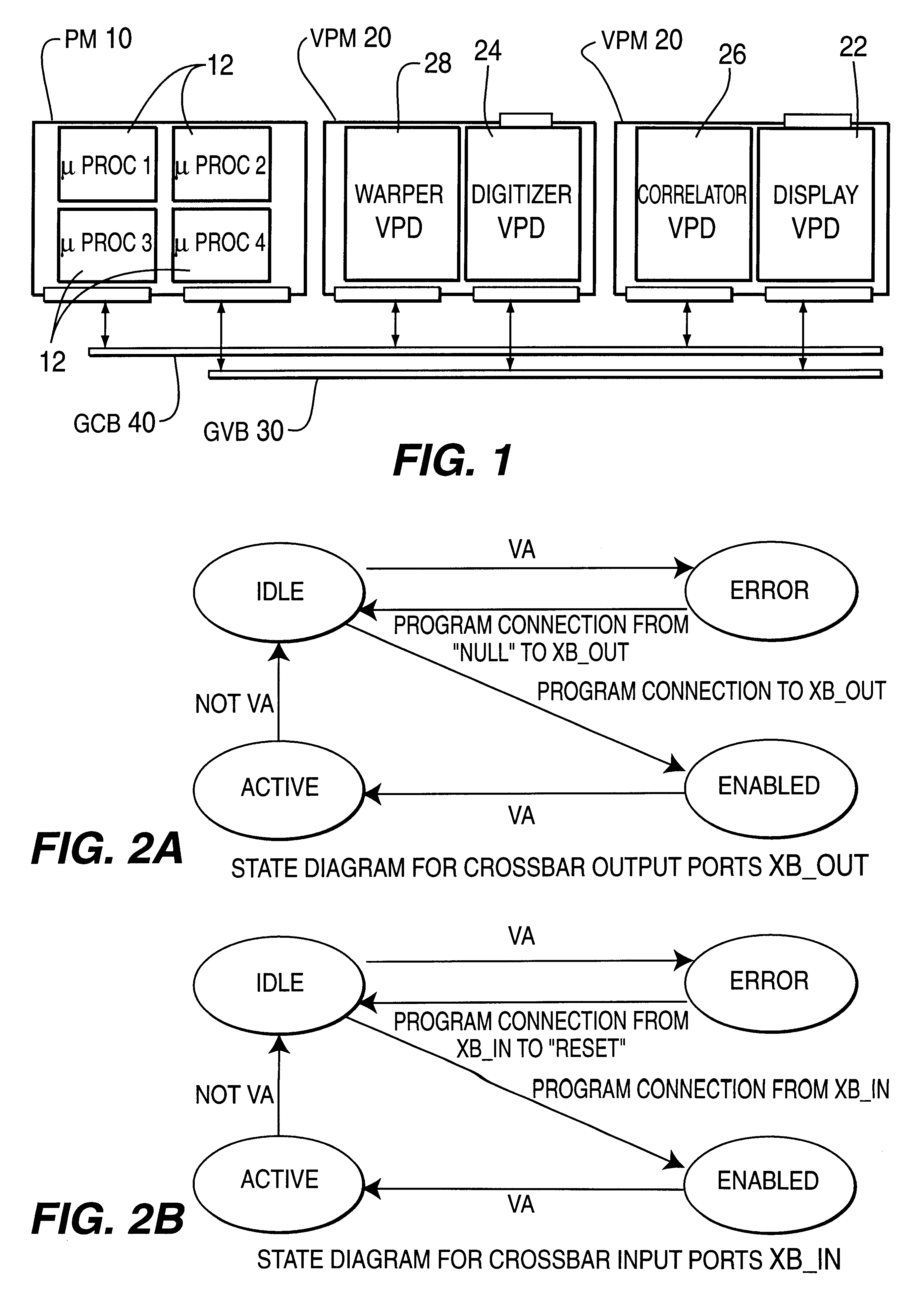

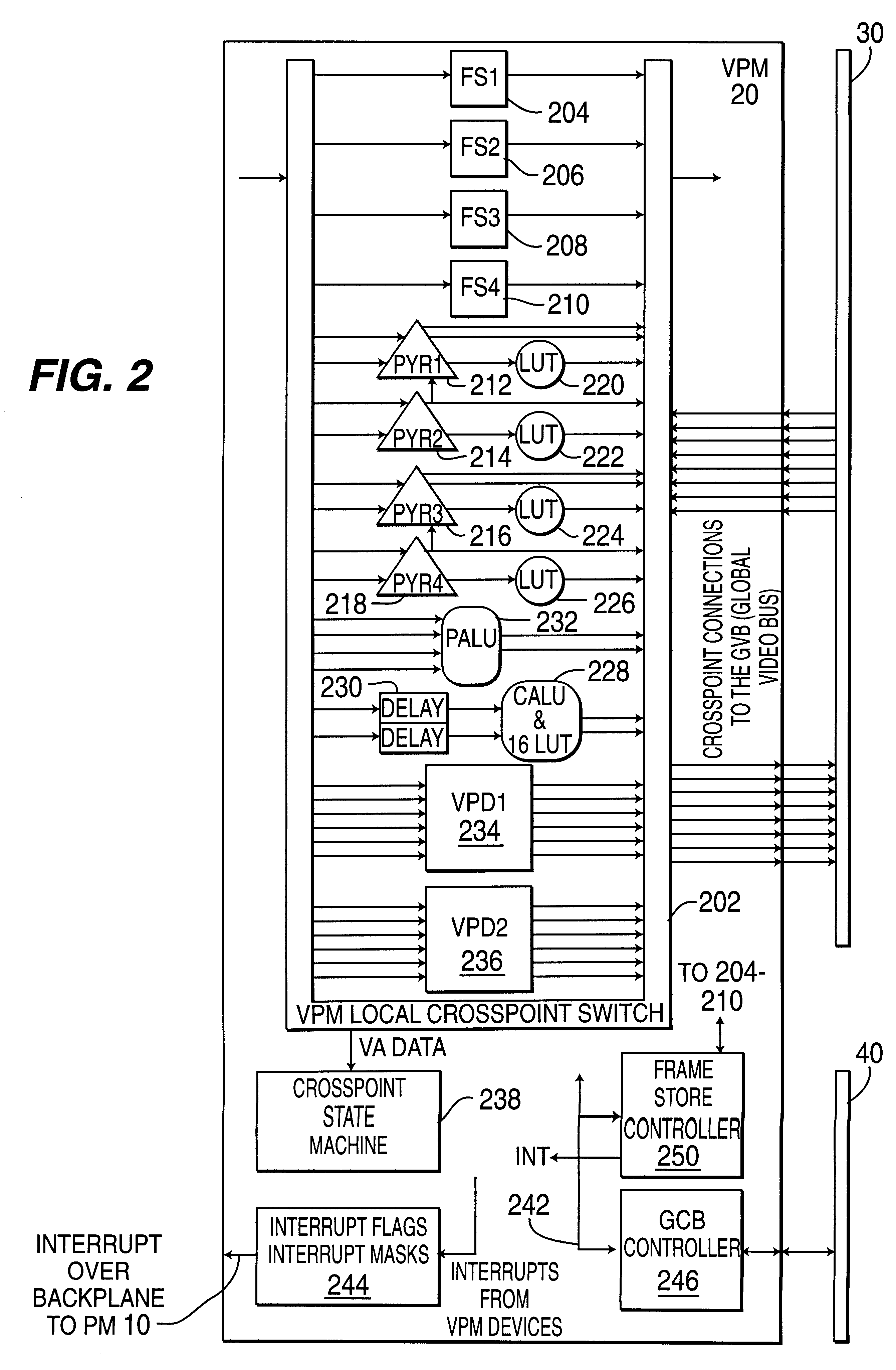

A real-time modular video processing system (VPS) which can be scaled smoothly from relatively small systems with modest amounts of hardware to very large, very powerful systems with significantly more hardware. The modular video processing system includes a processing module containing at least one general purpose microprocessor which controls hardware and software operation of the video processing system using control data and which also facilitates communications with external devices. One or more video processing modules are also provided, each containing parallel pipelined video hardware which is programmable by the control data to provide different video processing operations on an input stream of video data. Each video processing module also contains one or more connections for accepting one or more daughterboards which each perform a particular image processing task. A global video bus routes video data between the processing module and each video processing module and between respective processing modules, while a global control bus provides the control data to / from the processing module from / to the video processing modules separate from the video data on the global video bus. A hardware control library loaded on the processing module provides an application programming interface including high level C-callable functions which allow programming of the video hardware as components are added and subtracted from the video processing system for different applications.

Owner:SARNOFF CORP

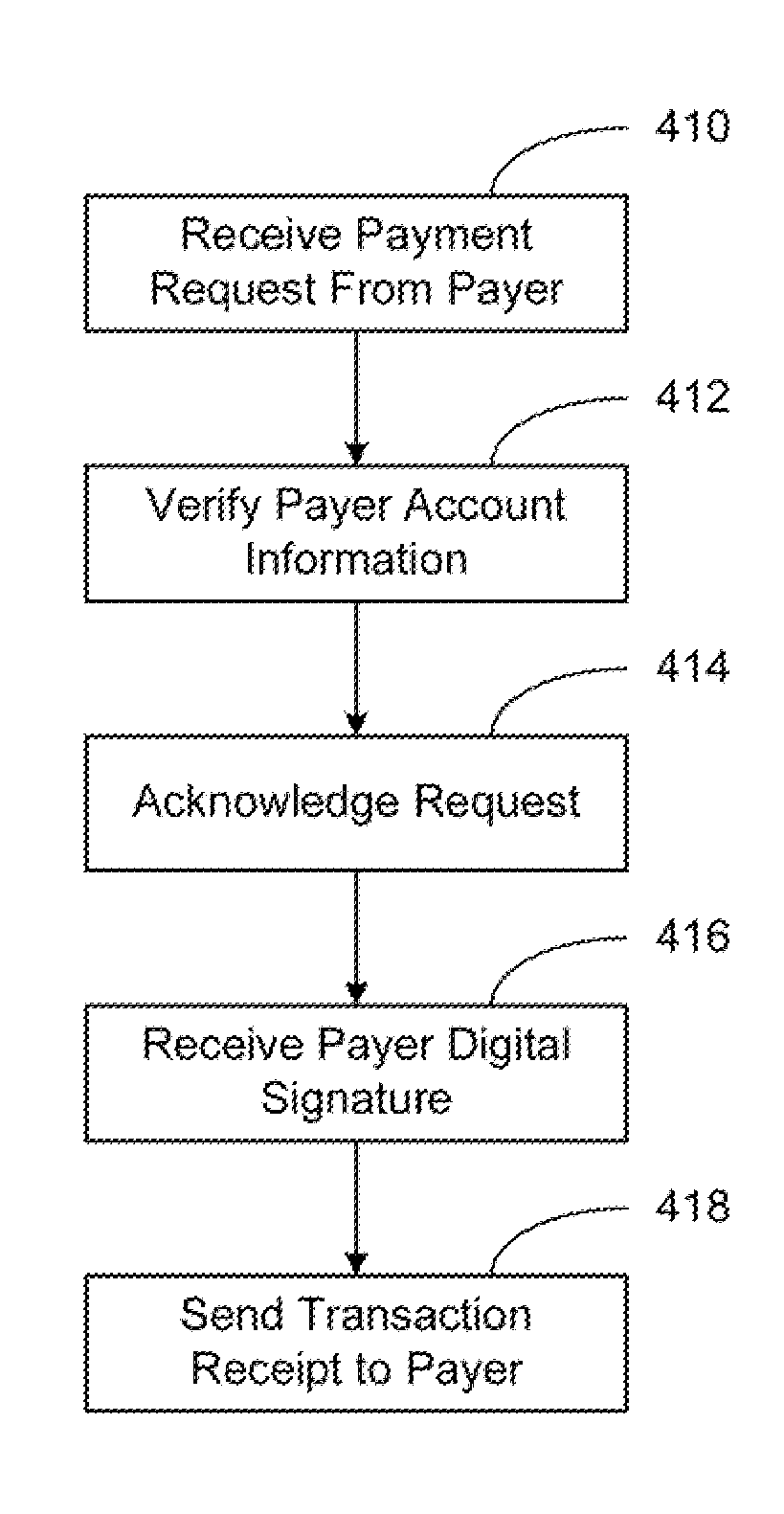

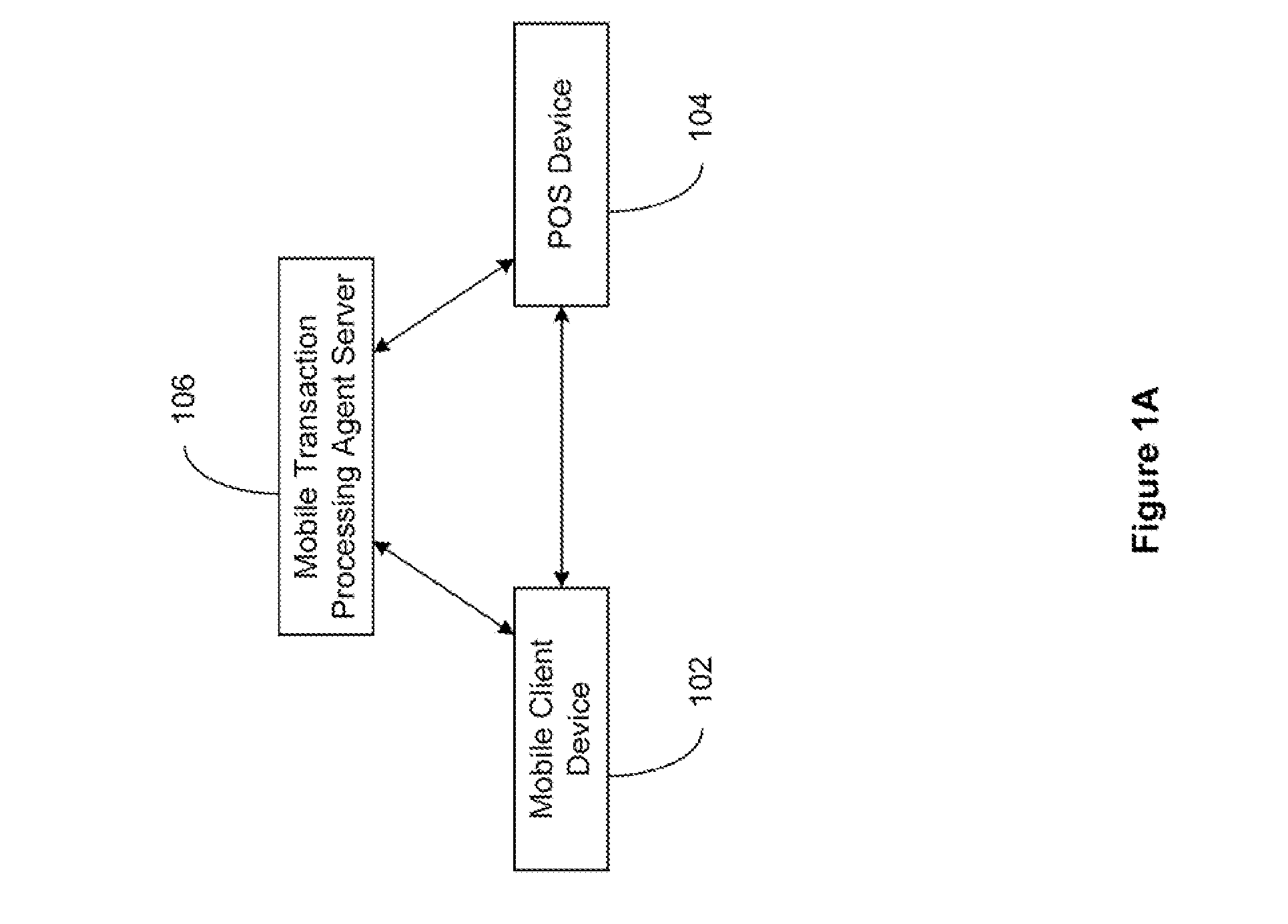

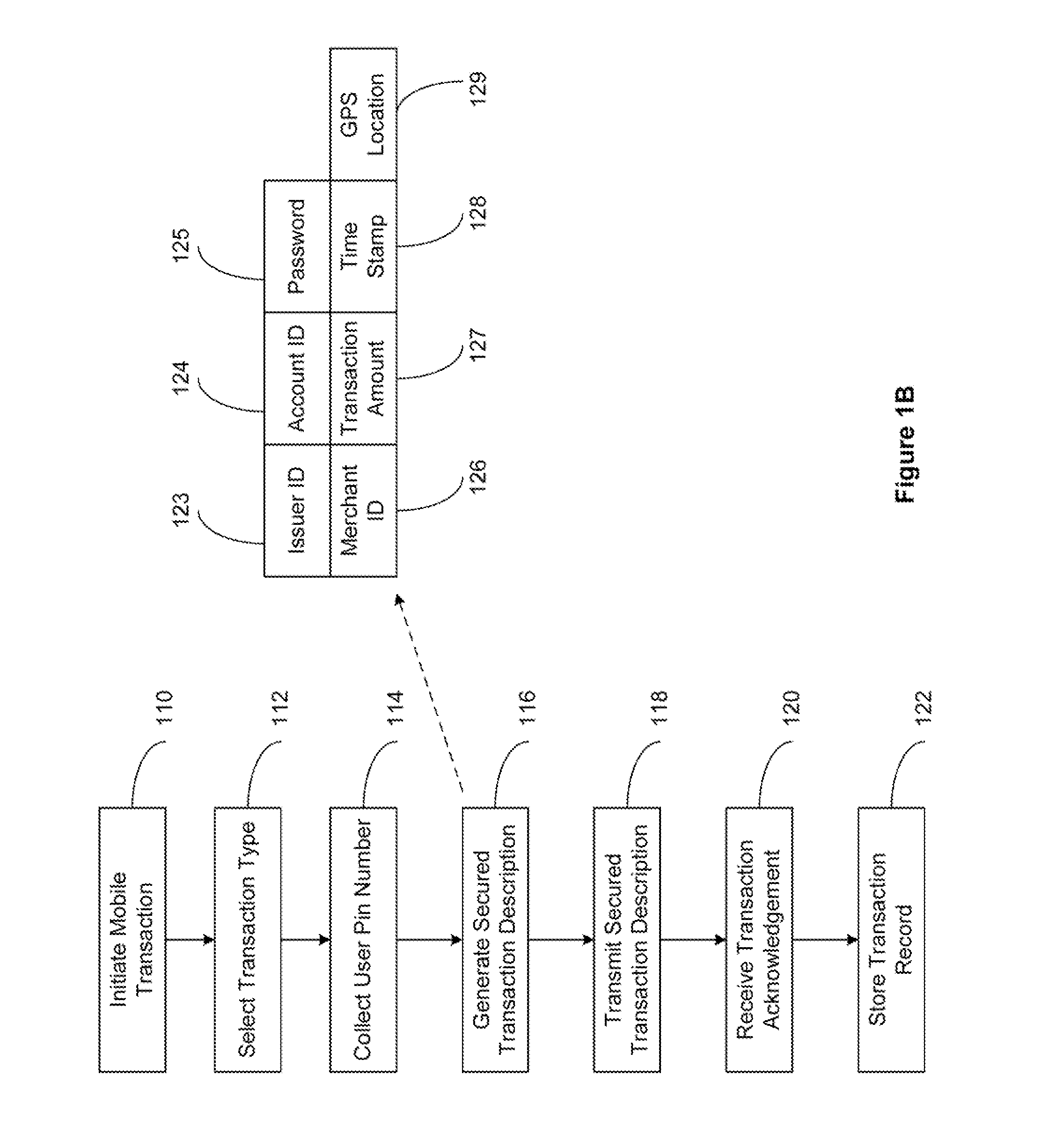

Secured Transaction System

The present invention relates to a secured transaction system. In one embodiment, a mobile transaction processing agent system includes a communication module configured to receive a secured transaction description from a mobile client device or an encrypted transaction description from a point-of-sale (POS) device, wherein the secured transaction description is in the form of a bar code generated by the mobile client device, an authentication module configured to decode the secured transaction description and verify the secured transaction description is valid based on the mobile client device or the point-of-sale device, and a transaction processing module configured to process the transaction in accordance with the secured transaction description.

Owner:DAI XIA

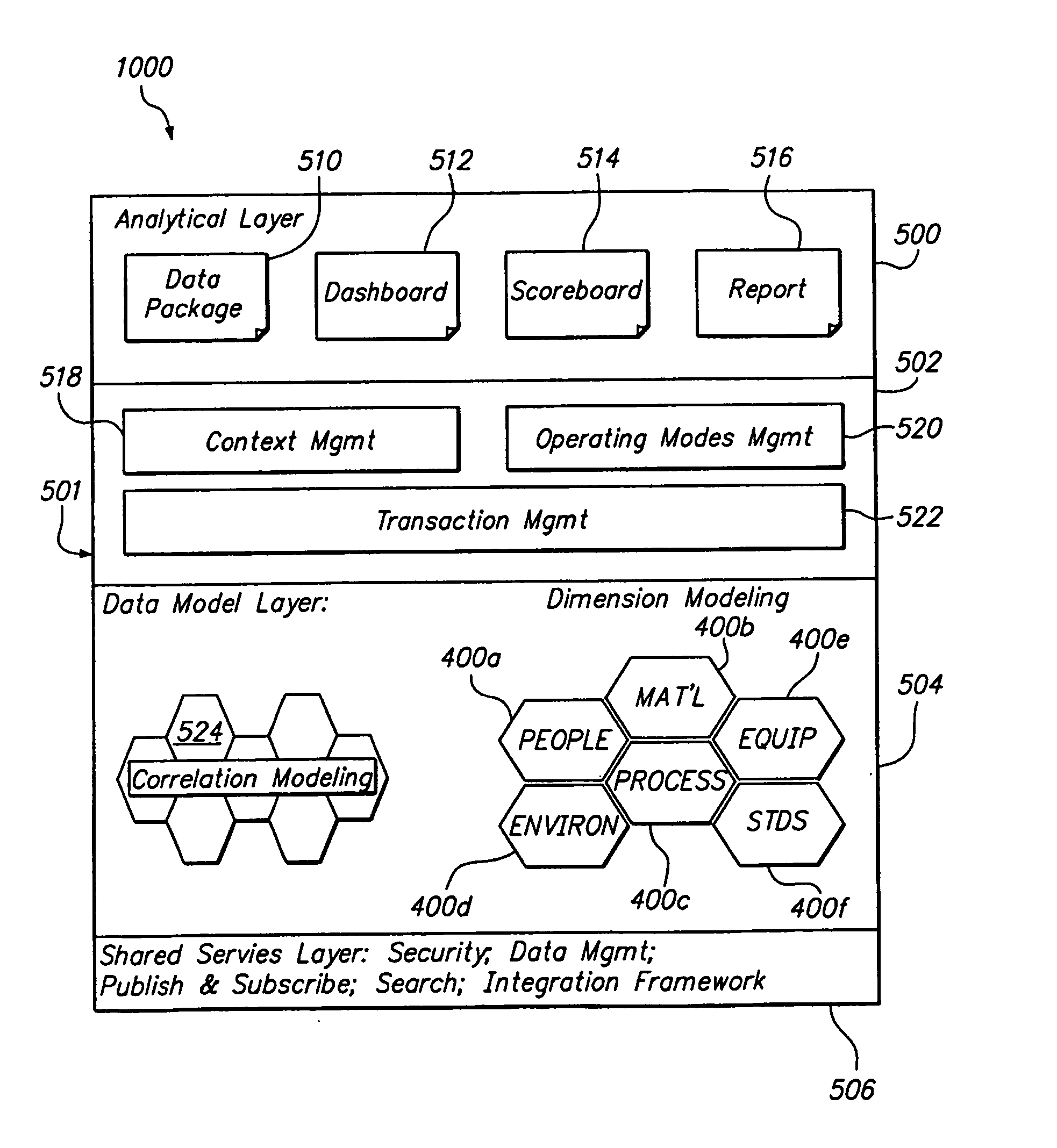

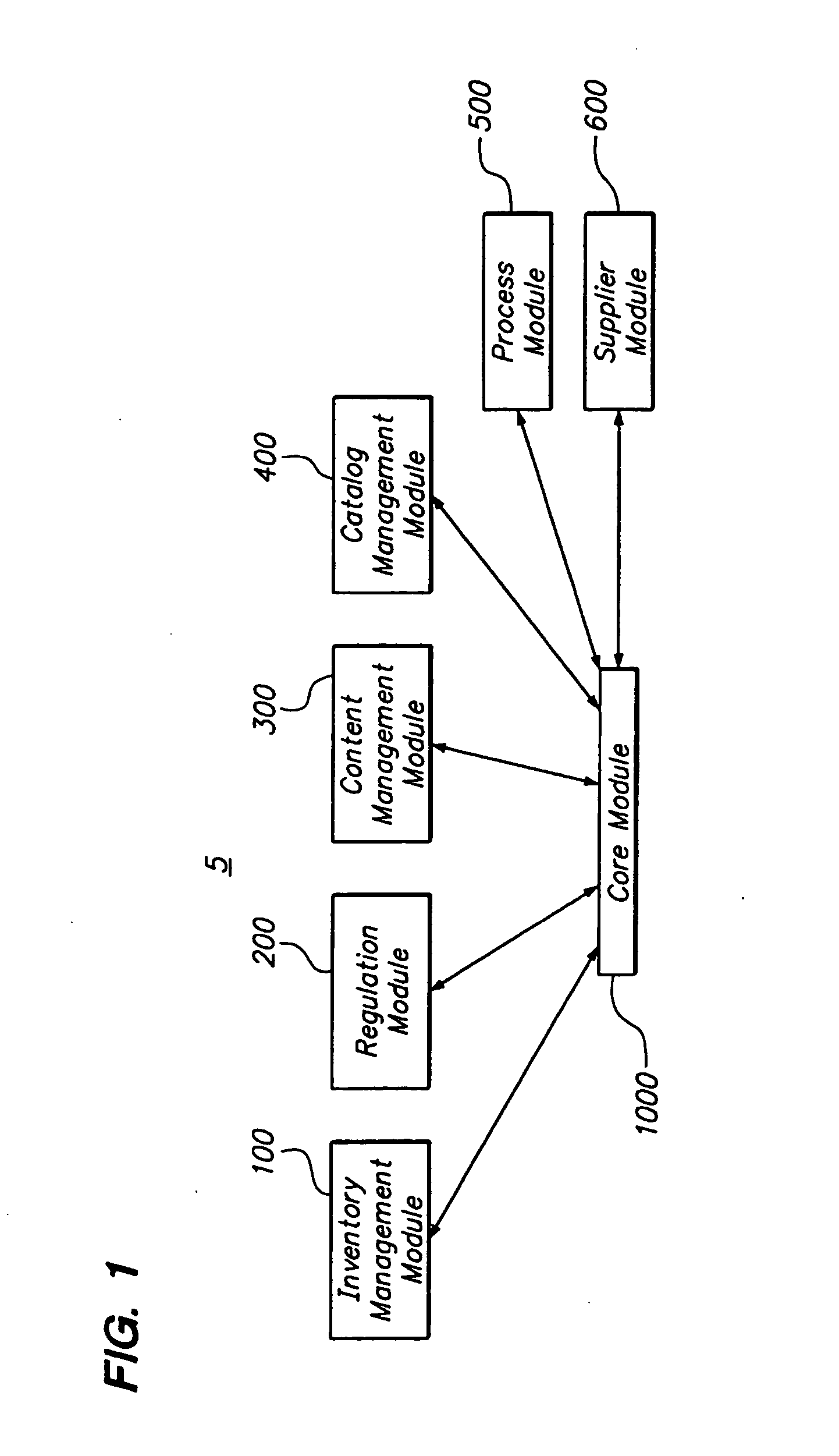

Systems and methods for managing the development and manufacturing of a drug

InactiveUS20070192715A1Easy to optimizeManagement complexityComputer-assisted medical data acquisitionTechnology managementGraphicsChemical reaction

Graphical user interfaces, computer readable media, and computer systems for monitoring a chemical process. An administration module sets a plurality of user preferences associated with the chemical process. A people management module defines a user role in the chemical process. An organization module defines an organizational structure of an organization that runs the chemical process. An equipment module defines equipment used in the chemical process. A material module controls a chemical used in the chemical process. A process module defines a chemical reaction in the chemical process.

Owner:ORACLE INT CORP

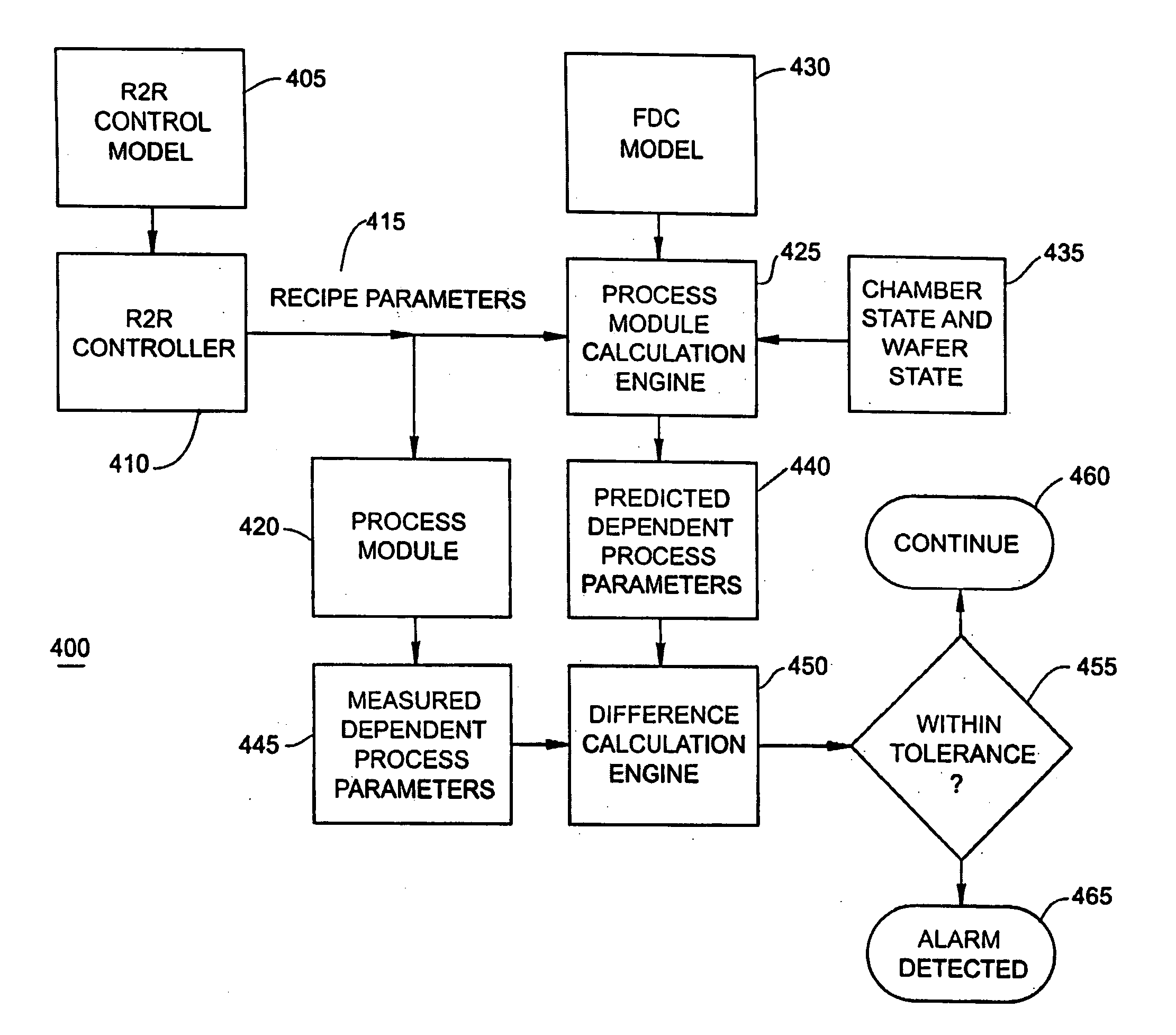

Fault detection and classification (FDC) using a run-to-run controller

ActiveUS20060184264A1Programme controlSemiconductor/solid-state device testing/measurementProcess moduleComputer science

A method for implementing FDC in an APC system including receiving an FDC model from memory; providing the FDC model to a process model calculation engine; computing a vector of predicted dependent process parameters using the process model calculation engine; receiving a process recipe comprising a set of recipe parameters, providing the process recipe to a process module; executing the process recipe to produce a vector of measured dependent process parameters; calculating a difference between the vector of predicted dependent process parameters and the vector of measured dependent process parameters; comparing the difference to a threshold value; and declaring a fault condition when the difference is greater than the threshold value.

Owner:TOKYO ELECTRON LTD

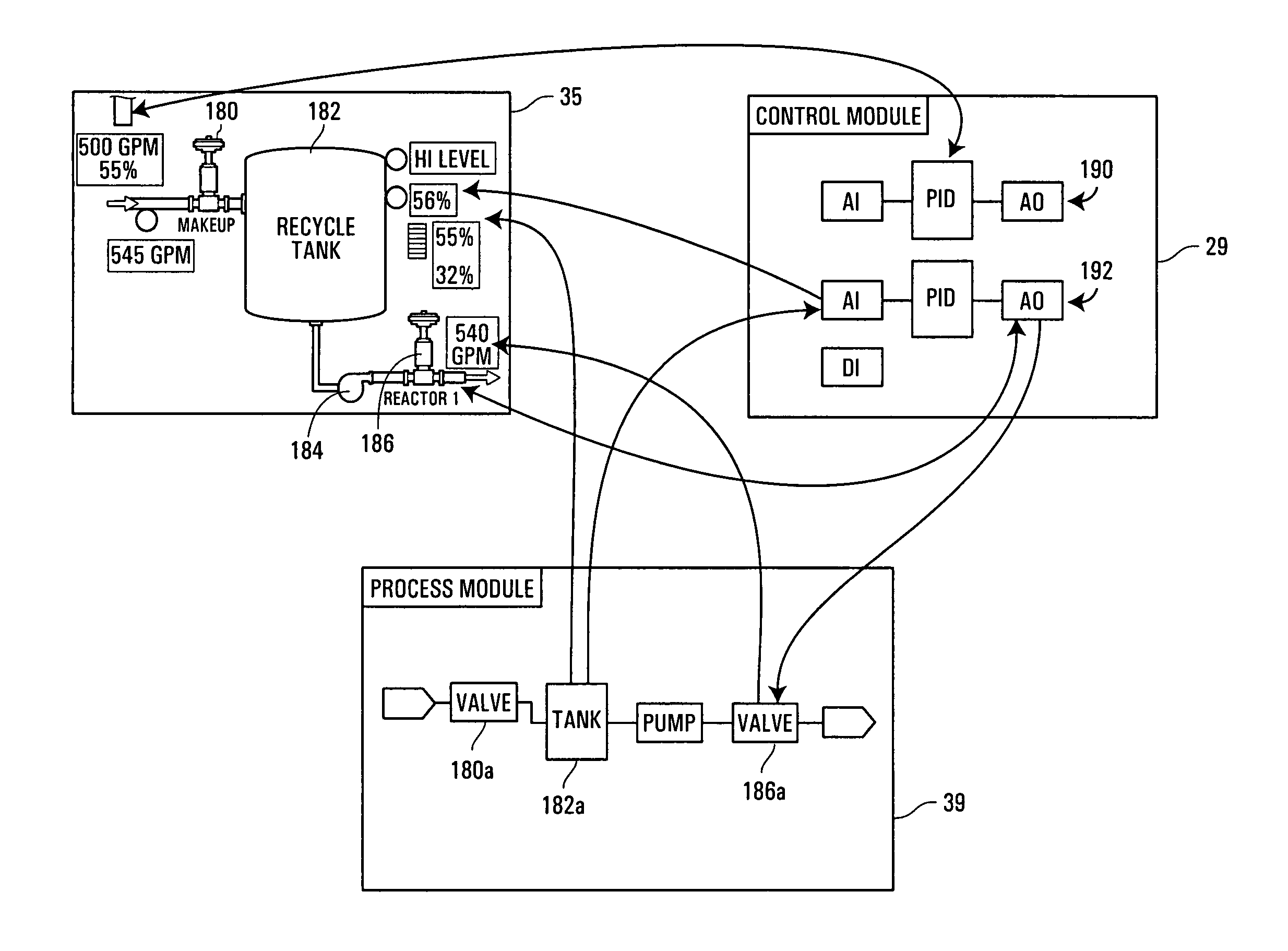

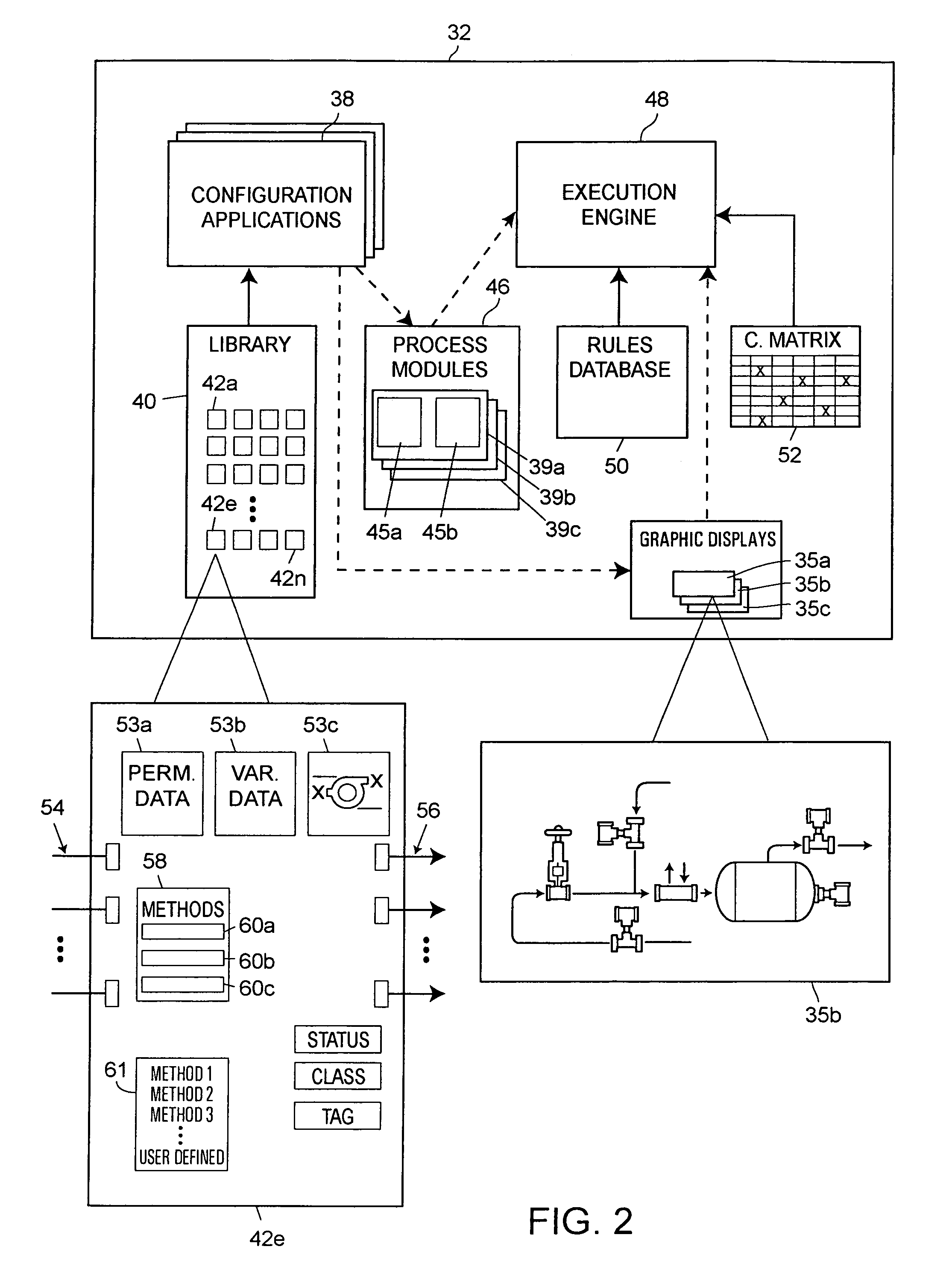

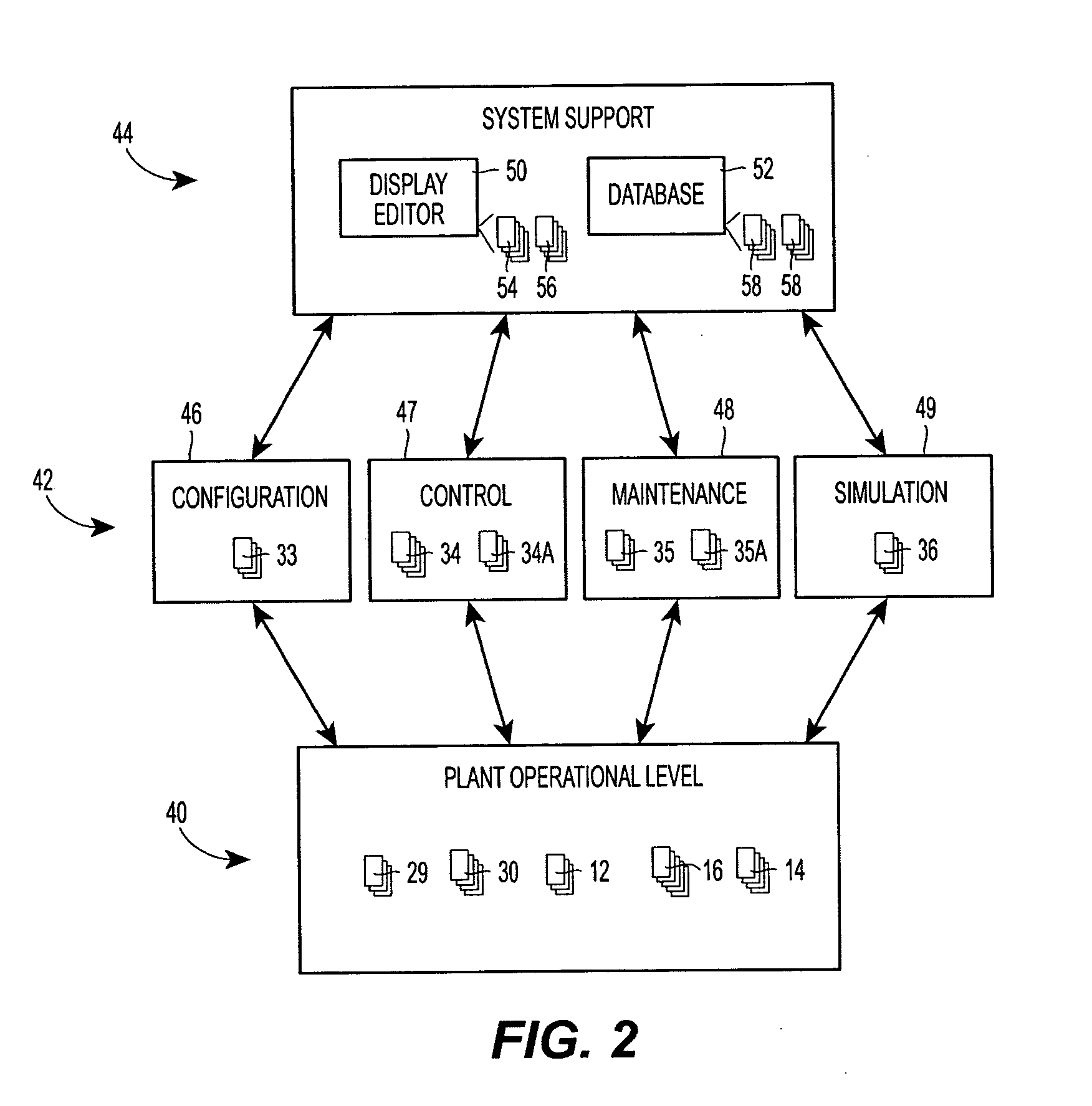

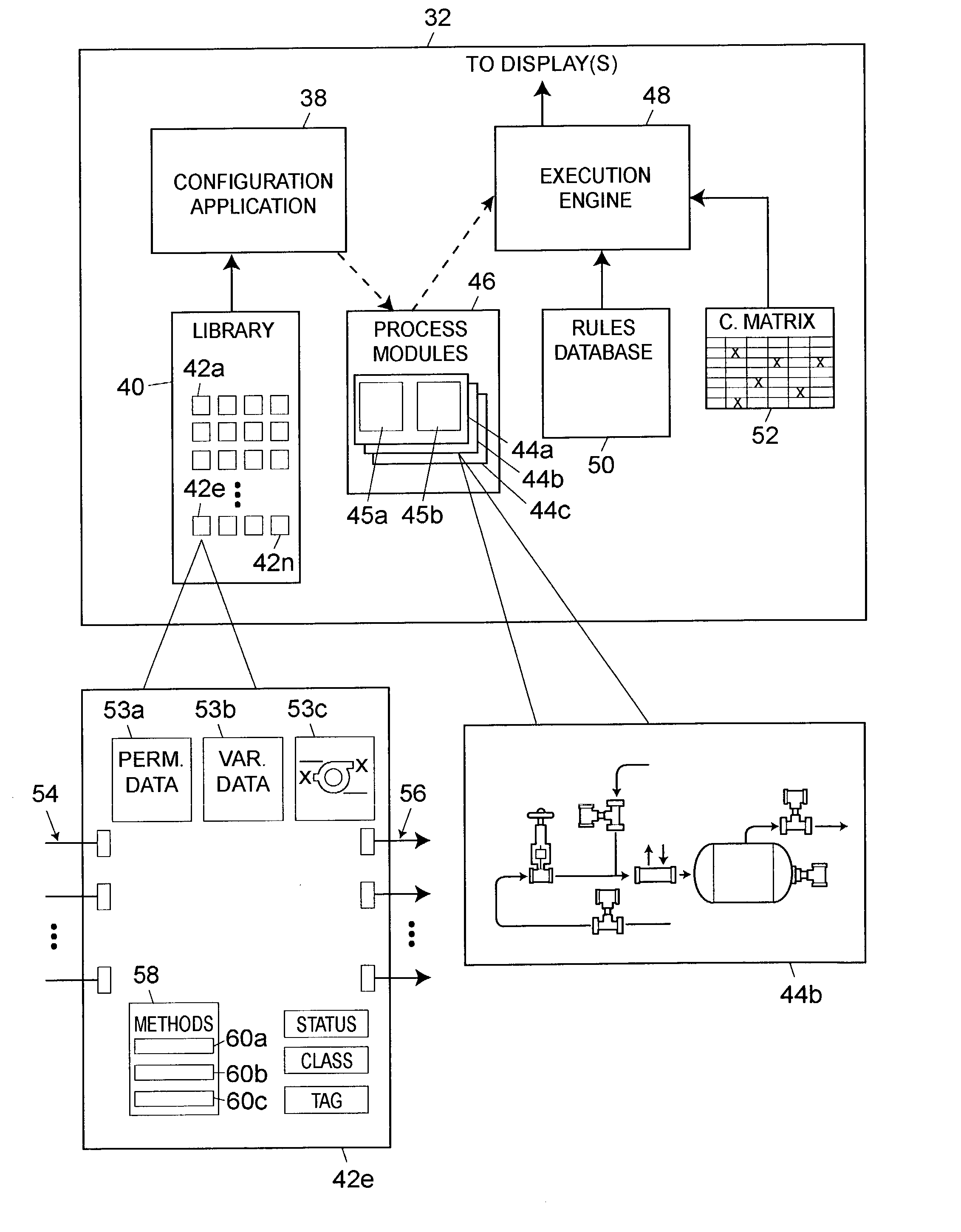

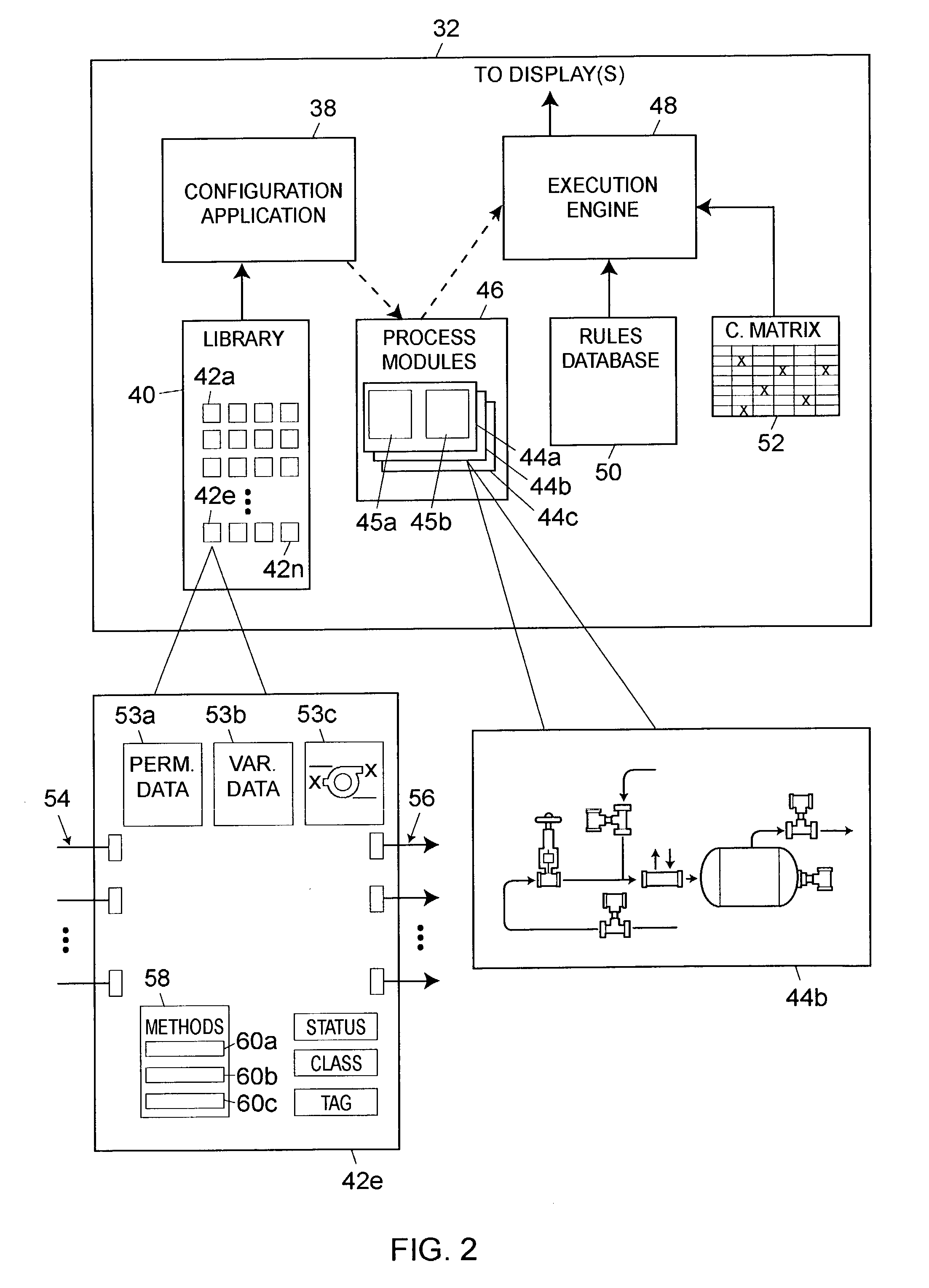

Integration of graphic display elements, process modules and control modules in process plants

InactiveUS7110835B2Easy to useEasy to implementSpace heating and ventilationDomestic heating detailsGraphicsProcess module

Graphic displays, which display information about process elements and the manner in which these elements are connected within a process, process modules, which simulate the operation of the elements depicted within the graphic displays and control modules, which perform on-line control activities within a process, may be communicatively connected together to provide a combined control, simulation and display environment that enables enhanced control, simulation and display activities. Smart process objects, which have both graphical and simulation elements, may used to create one or more graphic displays and one or more process simulation modules, each having elements which may communicate with one another to share data between the graphic displays and the process modules. Additionally, function blocks within control modules executed in the process plant may reference the elements within the graphic displays and the process modules (and vice versa) so that control modules may use simulated data developed by the process modules to perform better control, so that process modules may perform better simulation using actual pant data from the control modules, and so that the graphic displays may be used to illustrate actual process data and / or simulated process data as developed by the control modules and the process modules.

Owner:FISHER-ROSEMOUNT SYST INC

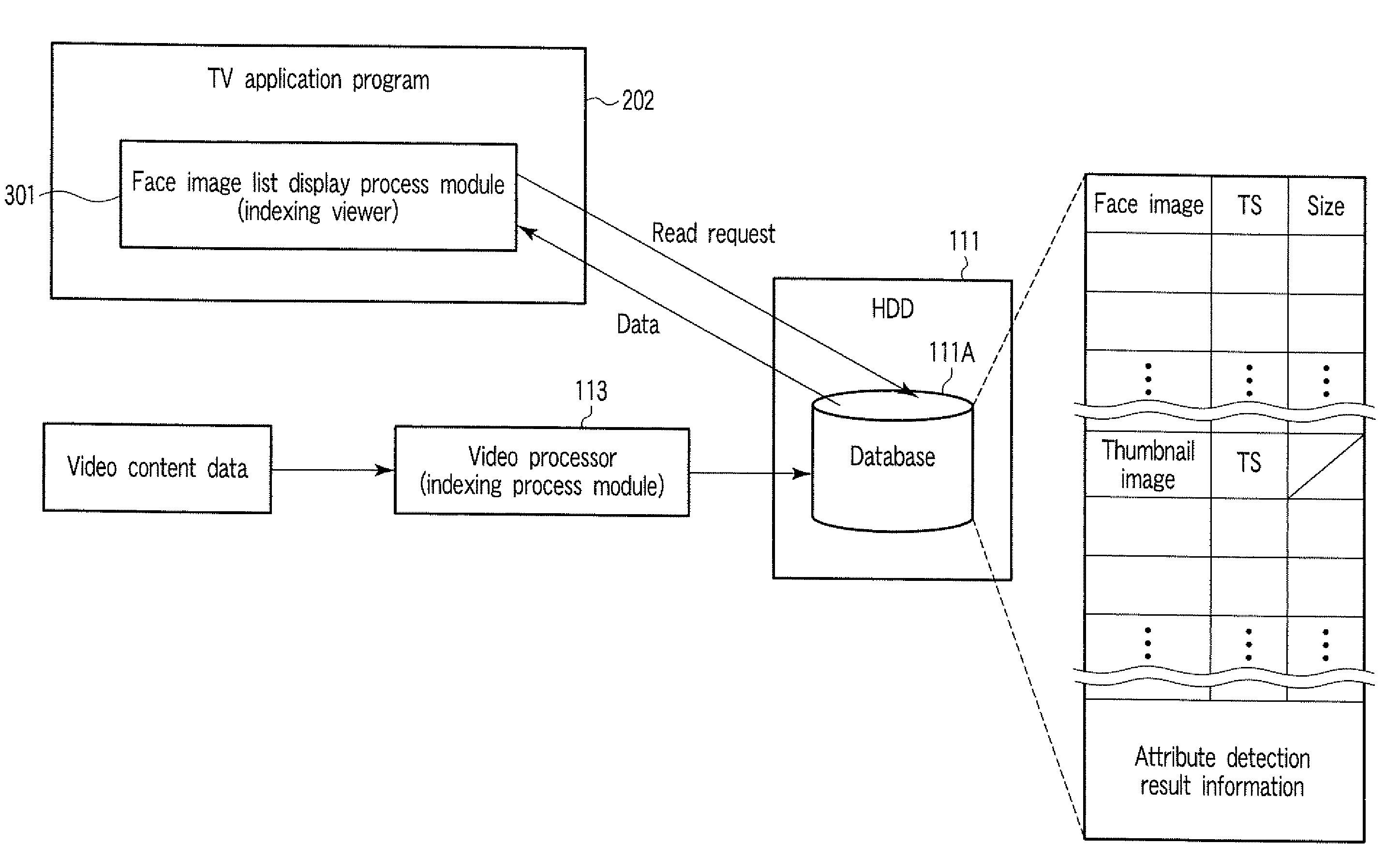

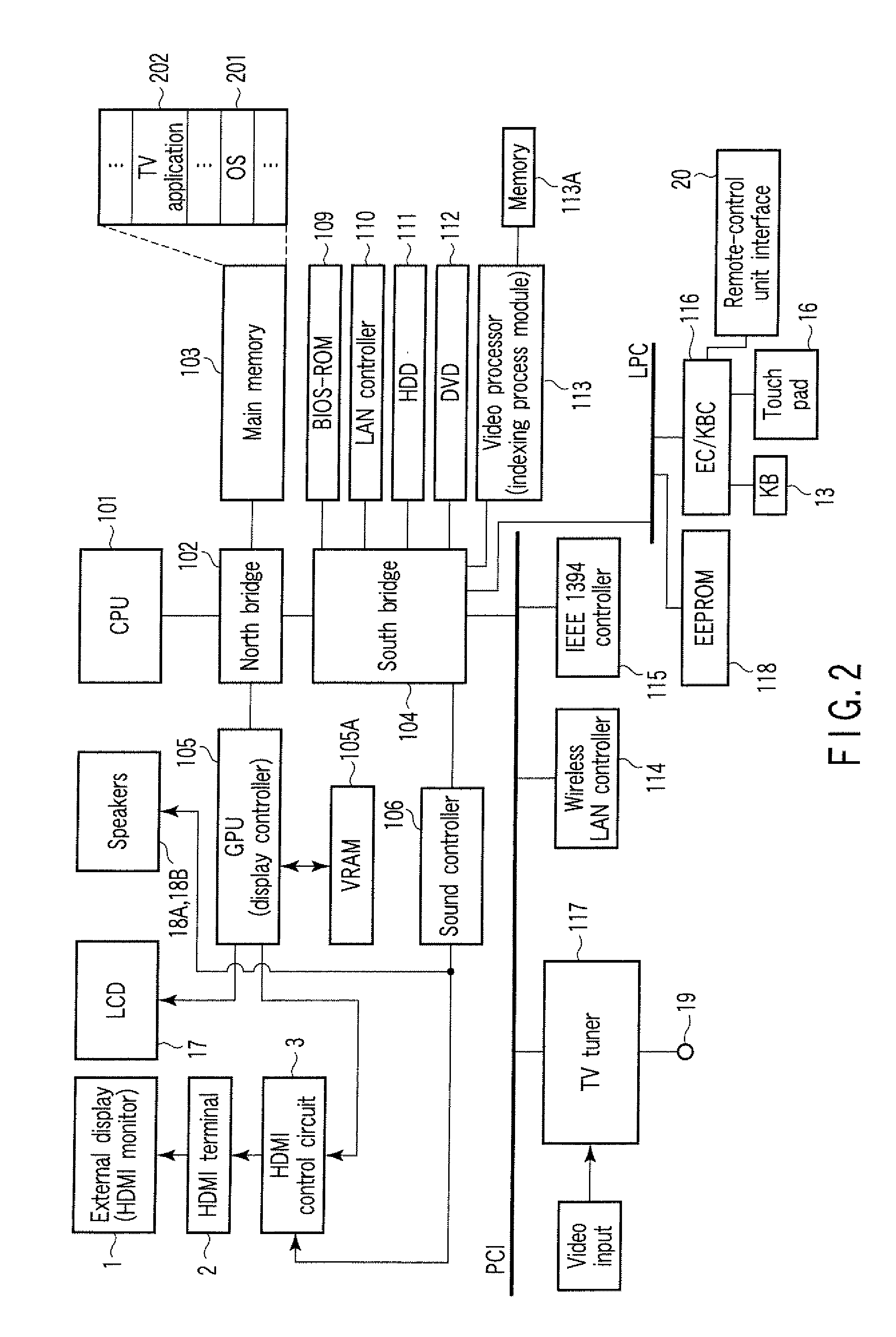

Electronic Apparatus and Image Display Method

ActiveUS20090185745A1Television system detailsMultimedia data retrievalImage extractionProcess module

According to one embodiment, an electronic apparatus comprises an image extraction module, an image list display process module, and a playback module. The image extraction module extracts a plurality of representative images from a sequence of video content data, and outputs time stamp information which is indicative of a time point at which each of the plurality of extracted representative images appears in the video content data. The image list display process module displays, on a display area, a list of representative images appearing in a period from a start position to a predetermined display constraining position of the sequence of the video content data among the plurality of extracted representative images, and constrains the display of the representative images appearing after the display constraining position among the plurality of representative images. The playback module plays back the video content data in response to input of a playback request event.

Owner:TOSHIBA CLIENT SOLUTIONS CO LTD

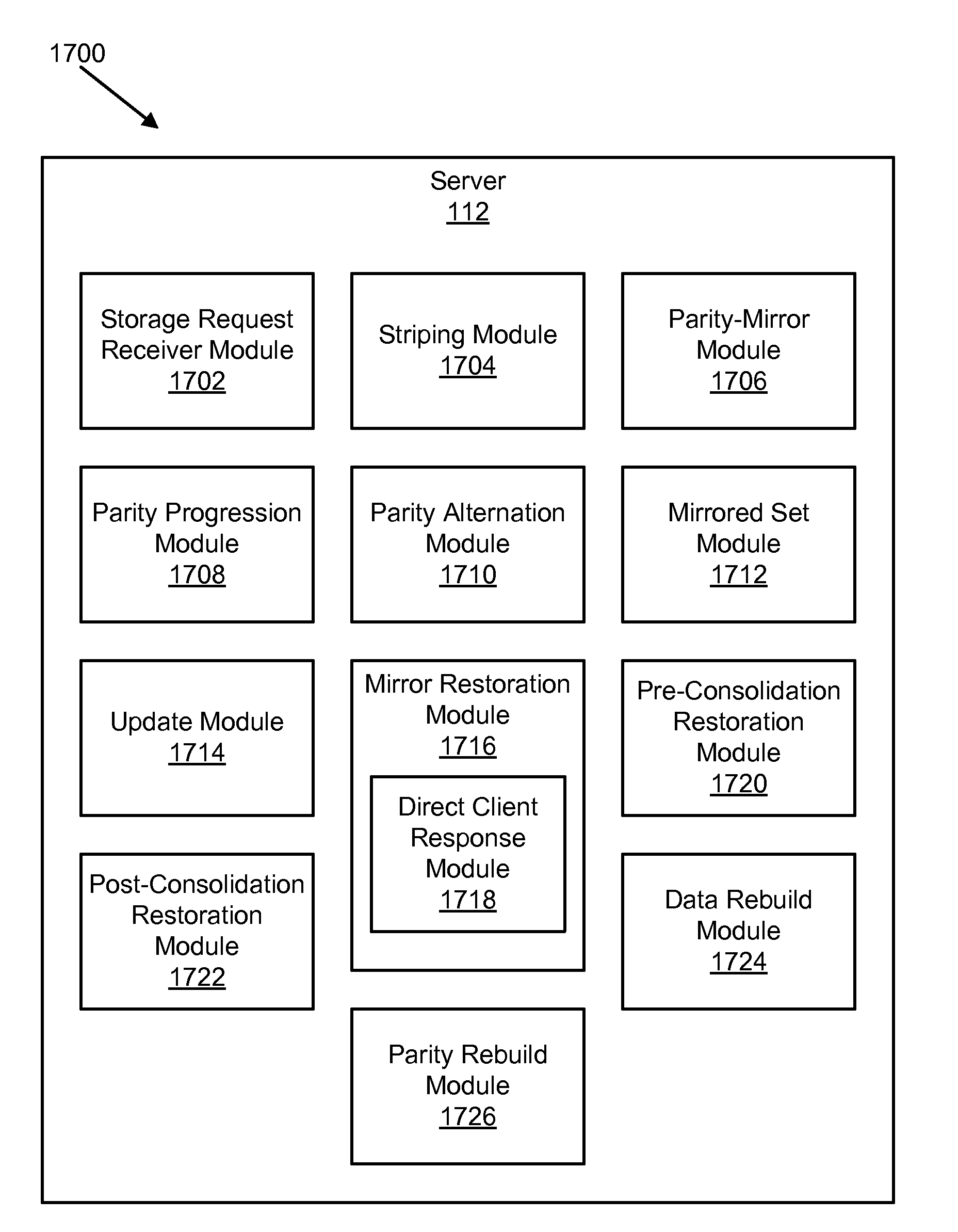

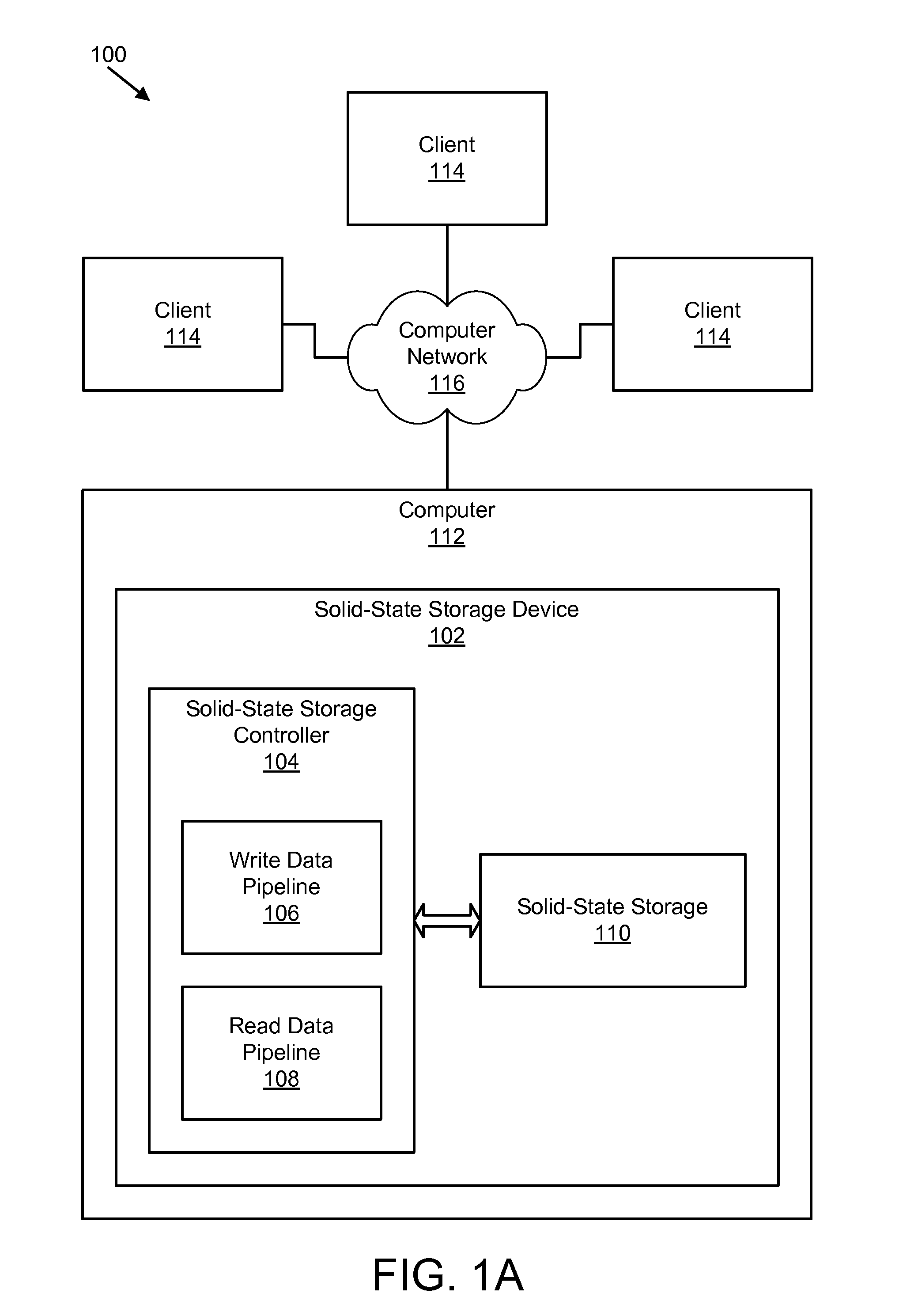

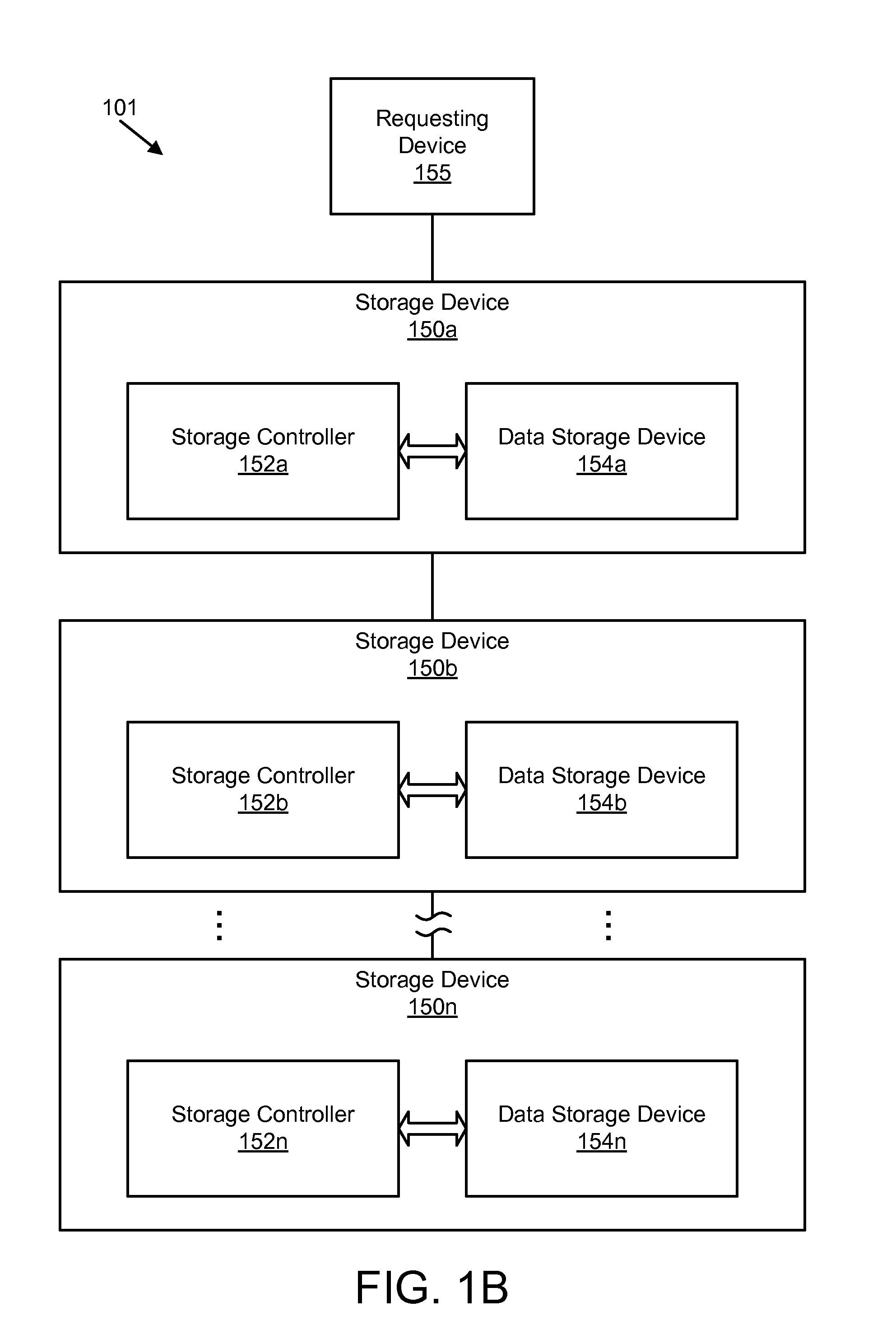

Apparatus, system, and method for data storage using progressive raid

ActiveUS20080168304A1Reliable and reliableImprove performanceEnergy efficient ICTInput/output to record carriersRAIDData segment

Owner:SANDISK TECH LLC

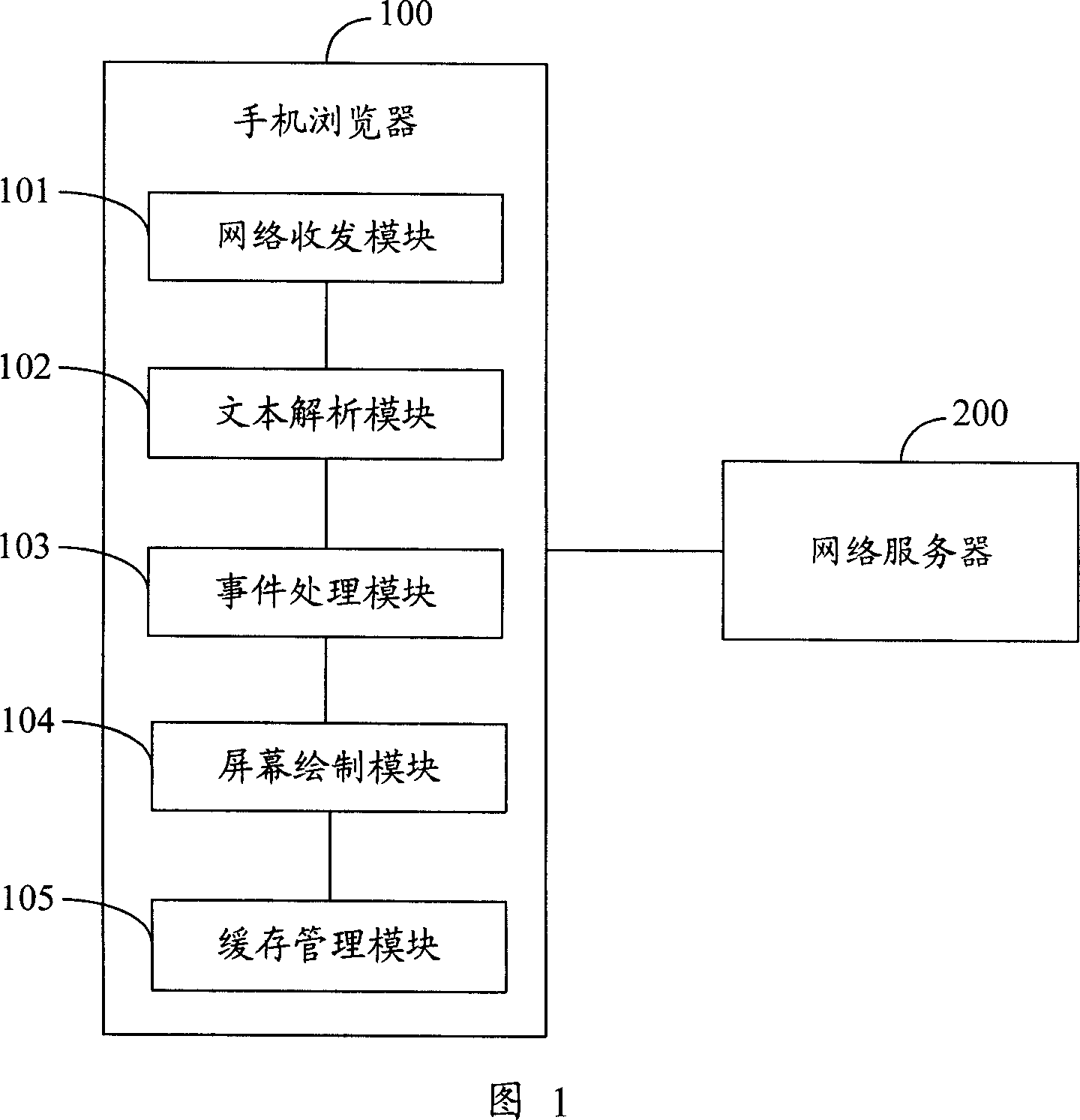

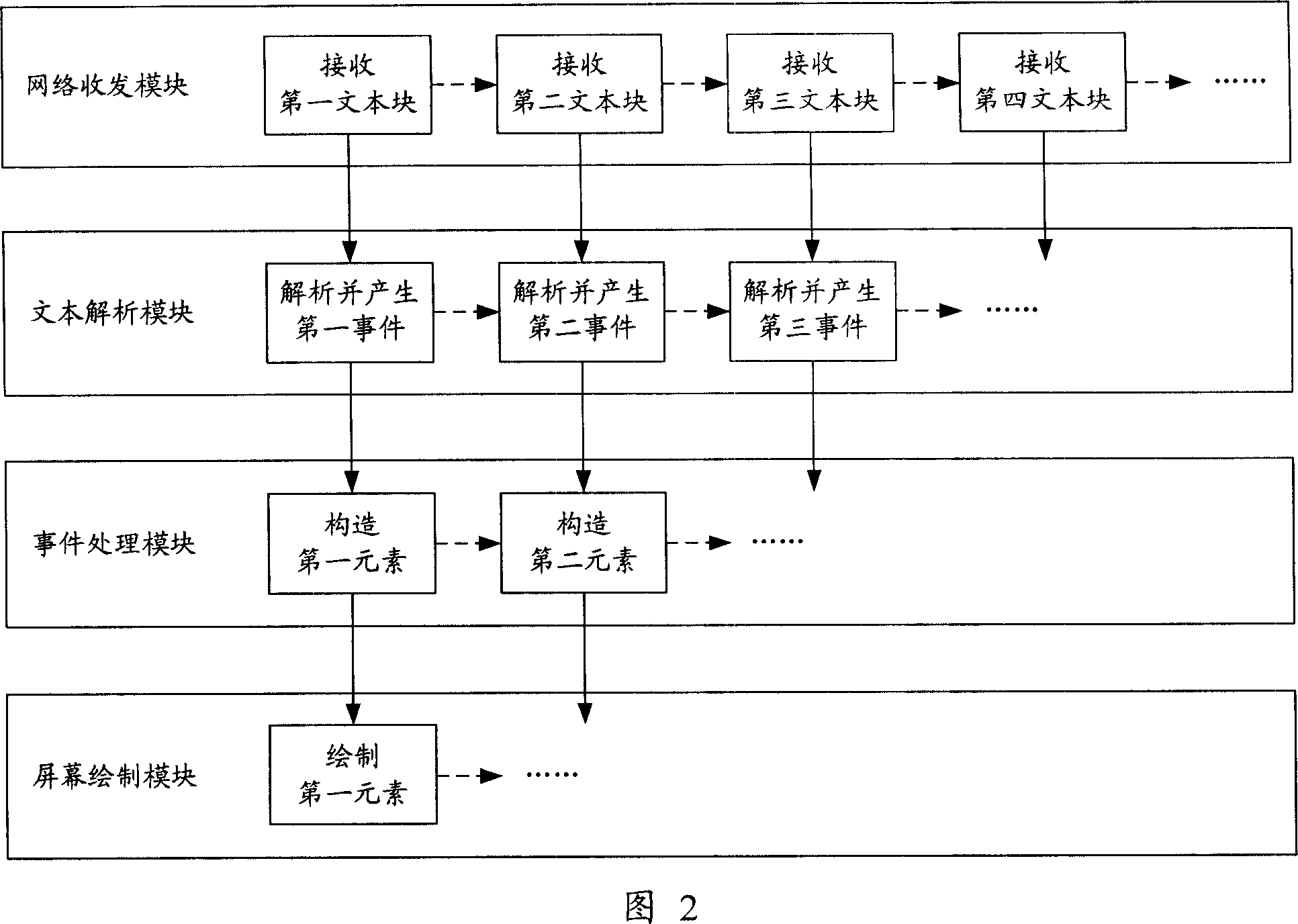

A method, system and device for quickly browsing webpage via mobile phone browser

ActiveCN101080055AImprove display efficiencyEnsure safetyRadio/inductive link selection arrangementsTelephone sets with user guidance/featuresProcess moduleComputer module

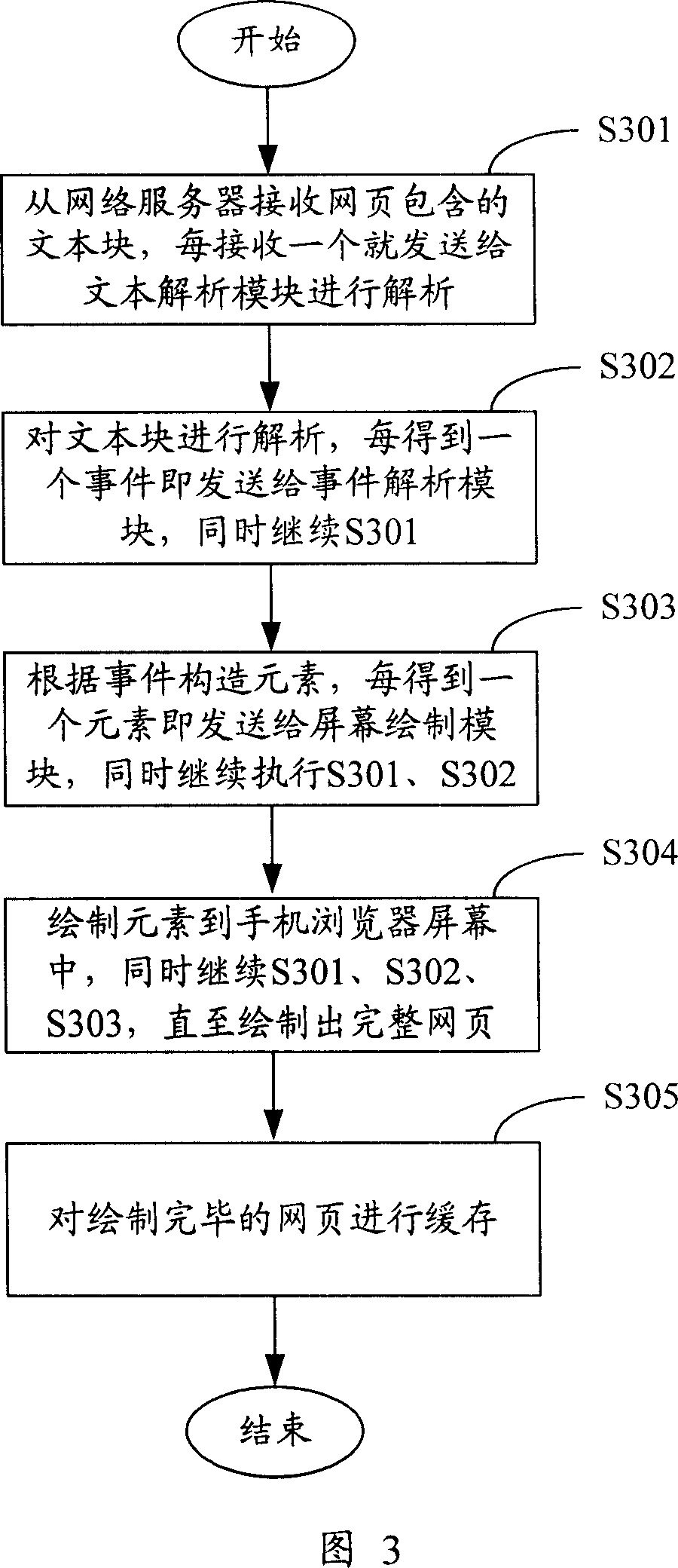

This invention provides a method, a system and a device for browsing webs quickly based on a cell phone browser, in which, the method includes: A, said cell phone browser utilizes its network T-R module to receive text block contained in the web from the network server and sends it to a text analyzing module, B, analyzing the received text block to get an event corresponding to the block and sending it to an event process module and executing step A at the same time, C, structuring elements based on the corresponding events of the text block and sending them to a screen drawing module and continuing step A, B and C till finishing a complete web.

Owner:TENCENT TECH (SHENZHEN) CO LTD

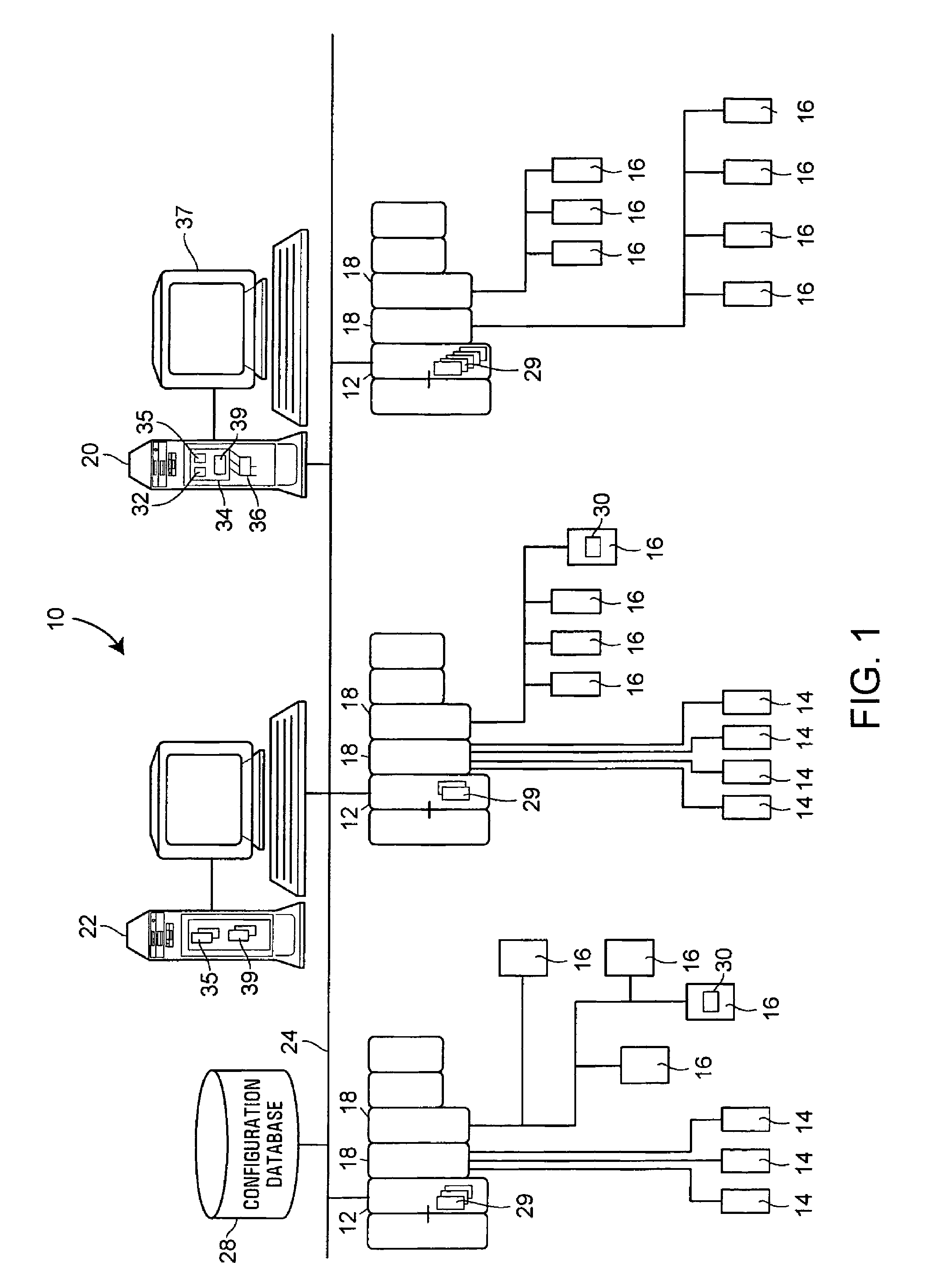

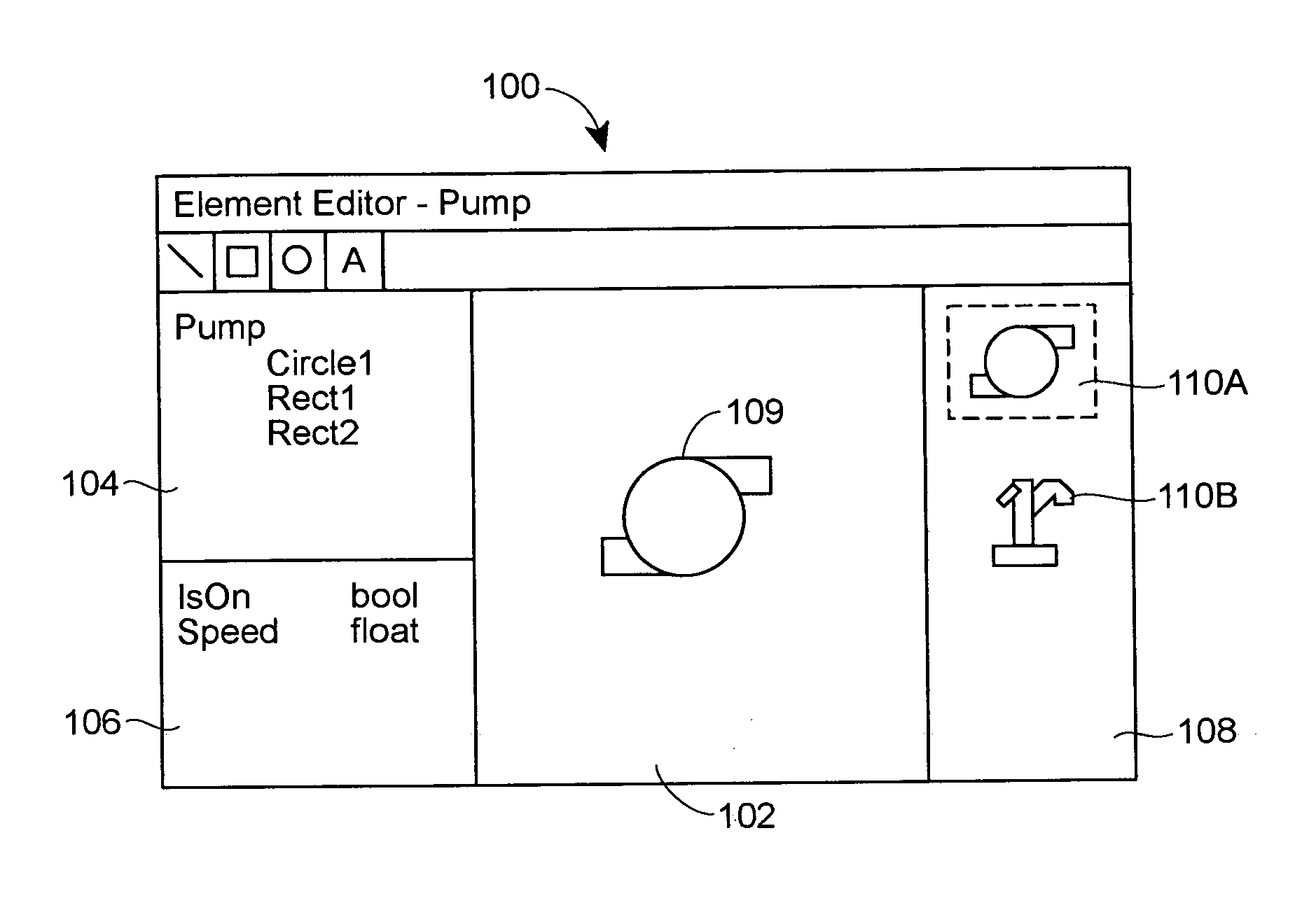

Graphics integration into a process configuration and control environment

ActiveUS20070139441A1Tedious and time-consumeGeometric CADElectric testing/monitoringGraphicsConfiguration item

Graphic elements and graphic displays are provided for use in a process environment to display information to one or more users about the process environment, such as the current state of device within a process plant. The graphic elements and display may be associated with various logical and physical elements within the process plant during configuration of the process plant, and may be configured and downloaded to the hardware within the process plant along with other configuration items, such as control routines. In particular, the graphic elements and graphic displays may be created and stored in a library, and may then be configured by being associated with various logical or physical entities within the plant. During the configuration process, the graphic elements and graphic displays may be associated with areas, equipment, process modules, control routines or control strategies of the plant as defined elsewhere in the plant configuration, or may be associated with interfaces or display devices, to define the hardware on which the graphic displays will execute during runtime, as well as to define the process entities to which these displays will be bound for display purposes. Still further, each of the graphic displays may be defined with a role or a functional use, such as an operator view, a maintenance view, etc., and these roles may be used to defined the proper access and use of the graphic displays within the runtime environment.

Owner:FISHER-ROSEMOUNT SYST INC

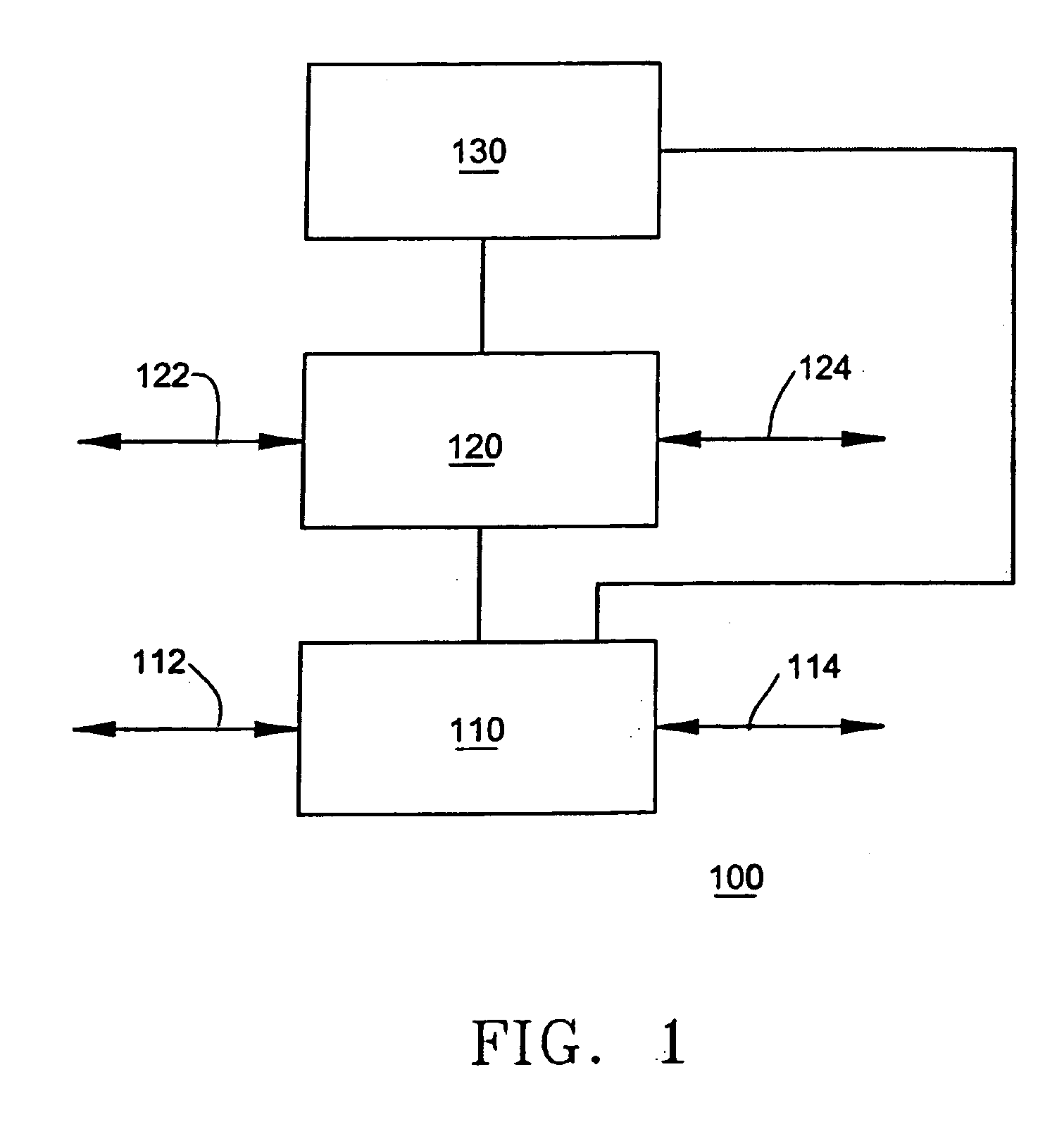

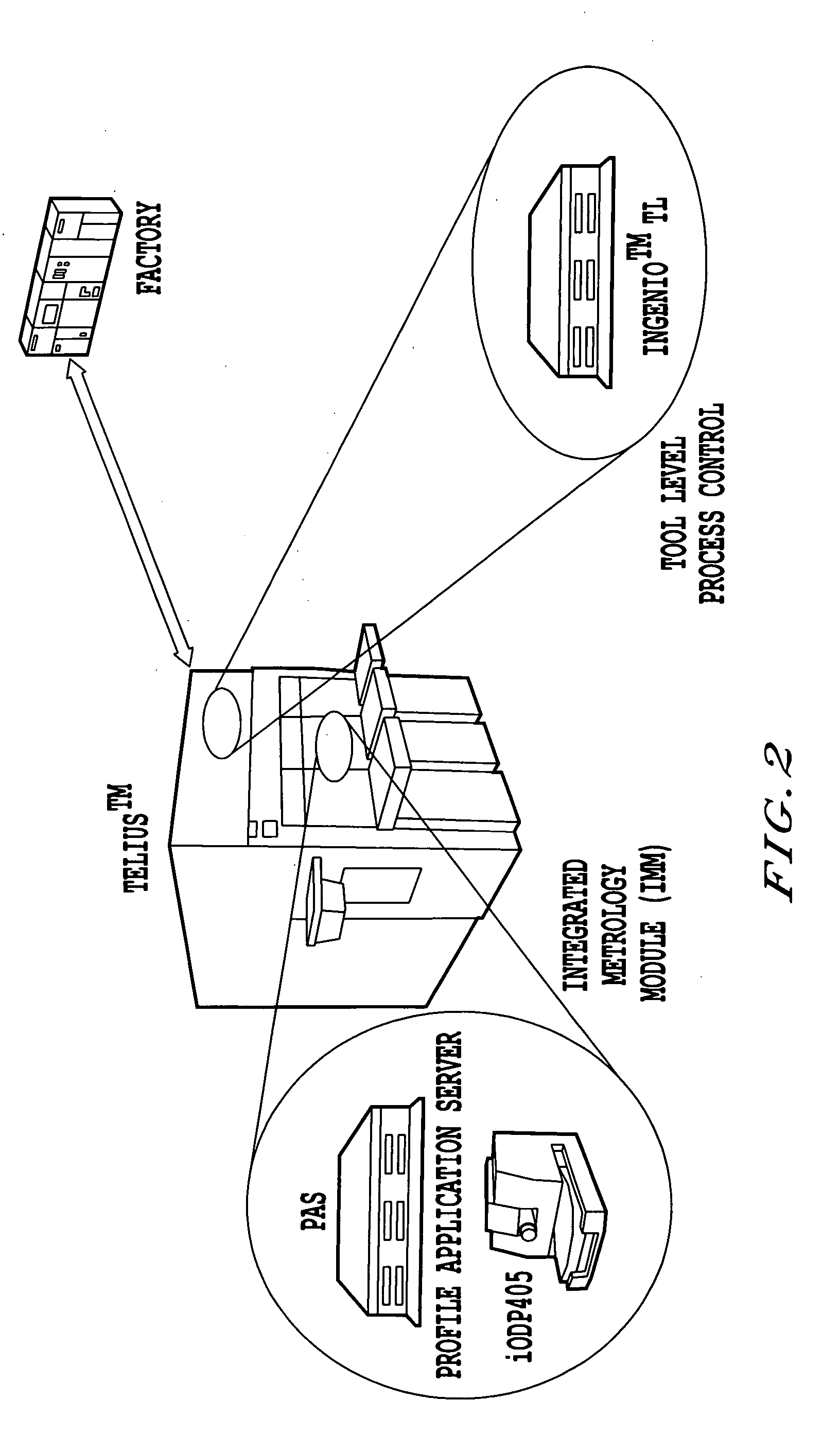

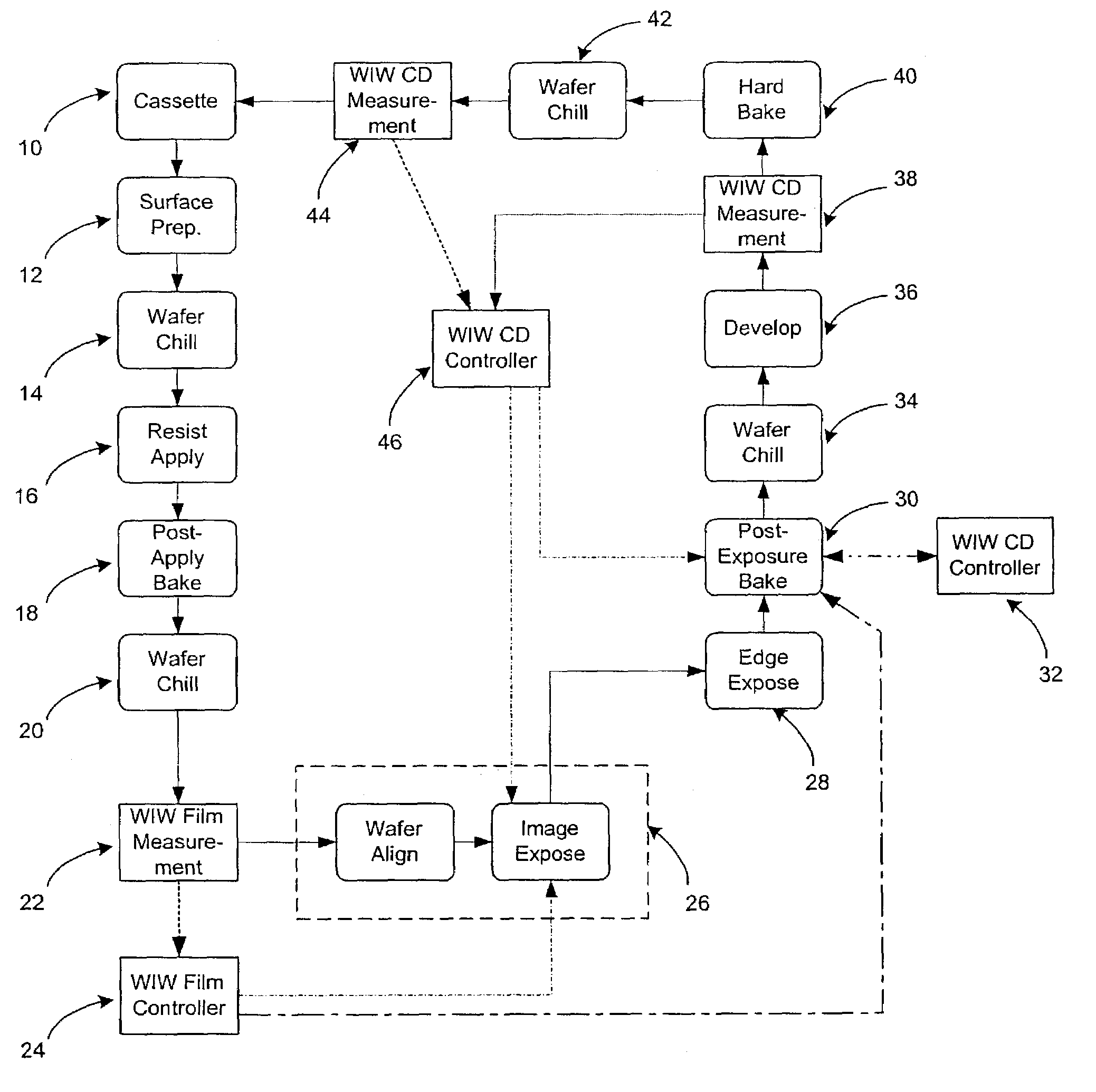

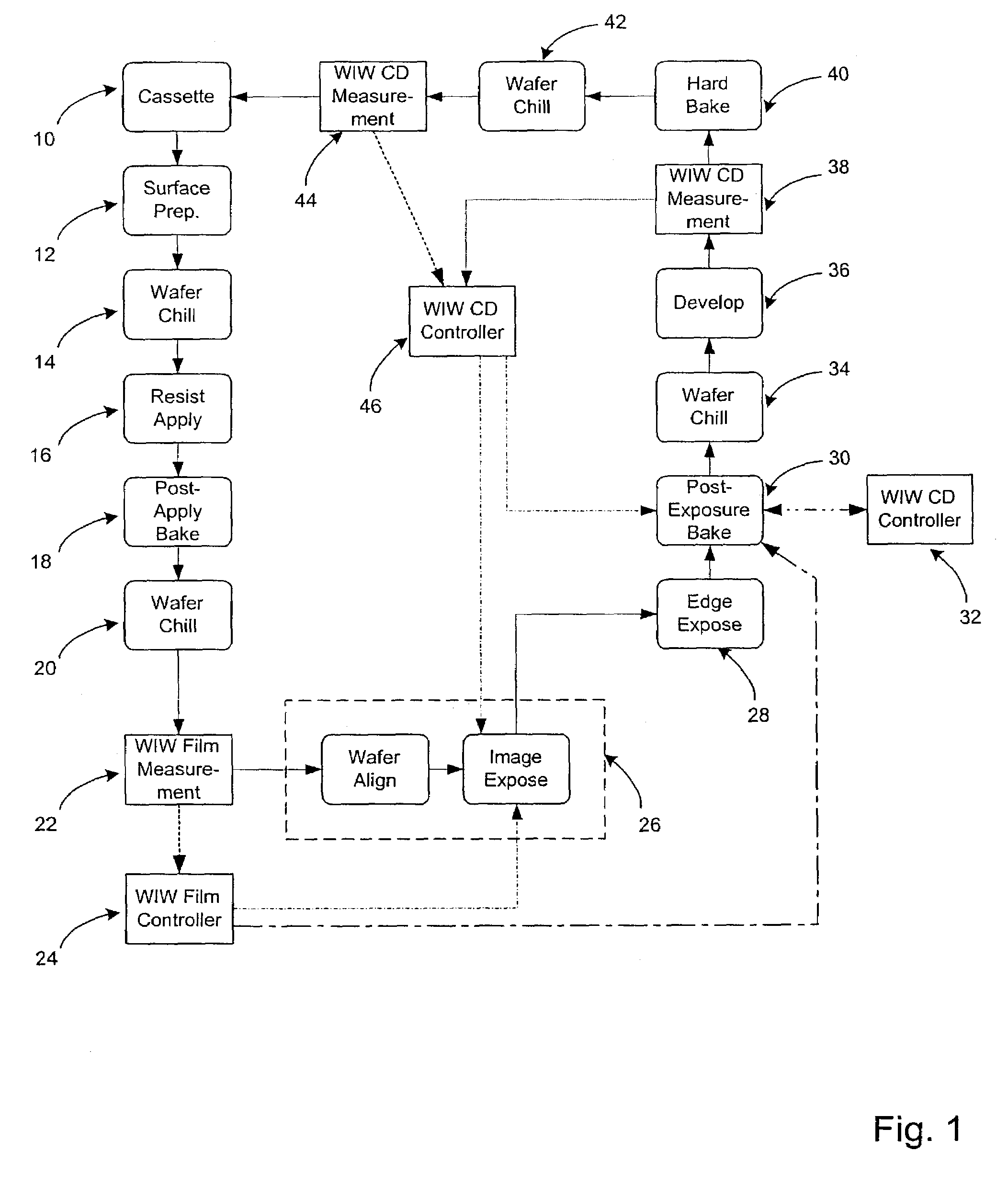

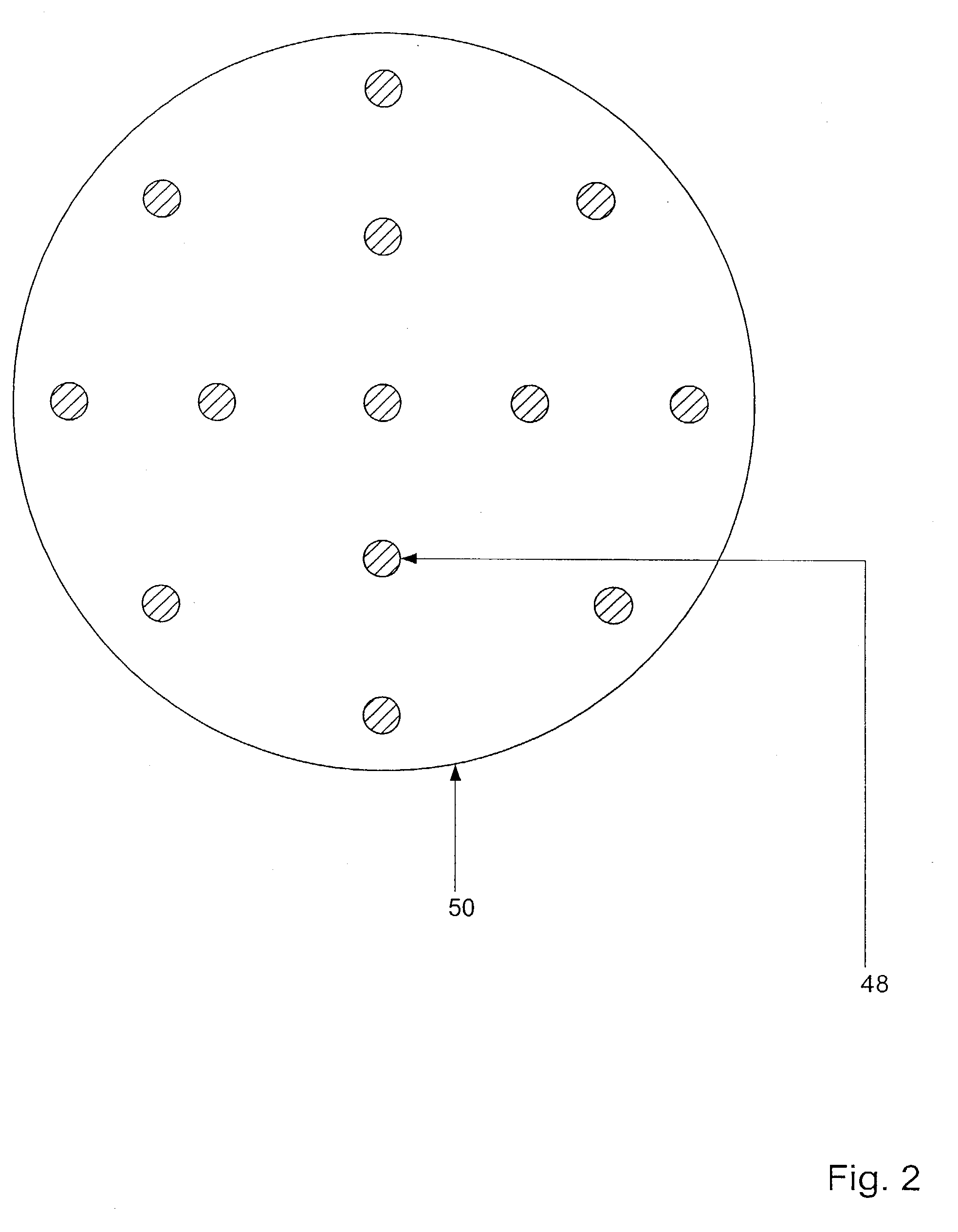

Methods and systems for lithography process control

InactiveUS6987572B2High performance bin distributionReduce yieldSemiconductor/solid-state device testing/measurementSolid-state devicesLithography processProcess module

Methods and systems for evaluating and controlling a lithography process are provided. For example, a method for reducing within wafer variation of a critical metric of a lithography process may include measuring at least one property of a resist disposed upon a wafer during the lithography process. A critical metric of a lithography process may include, but may not be limited to, a critical dimension of a feature formed during the lithography process. The method may also include altering at least one parameter of a process module configured to perform a step of the lithography process to reduce within wafer variation of the critical metric. The parameter of the process module may be altered in response to at least the one measured property of the resist.

Owner:KLA TENCOR TECH CORP

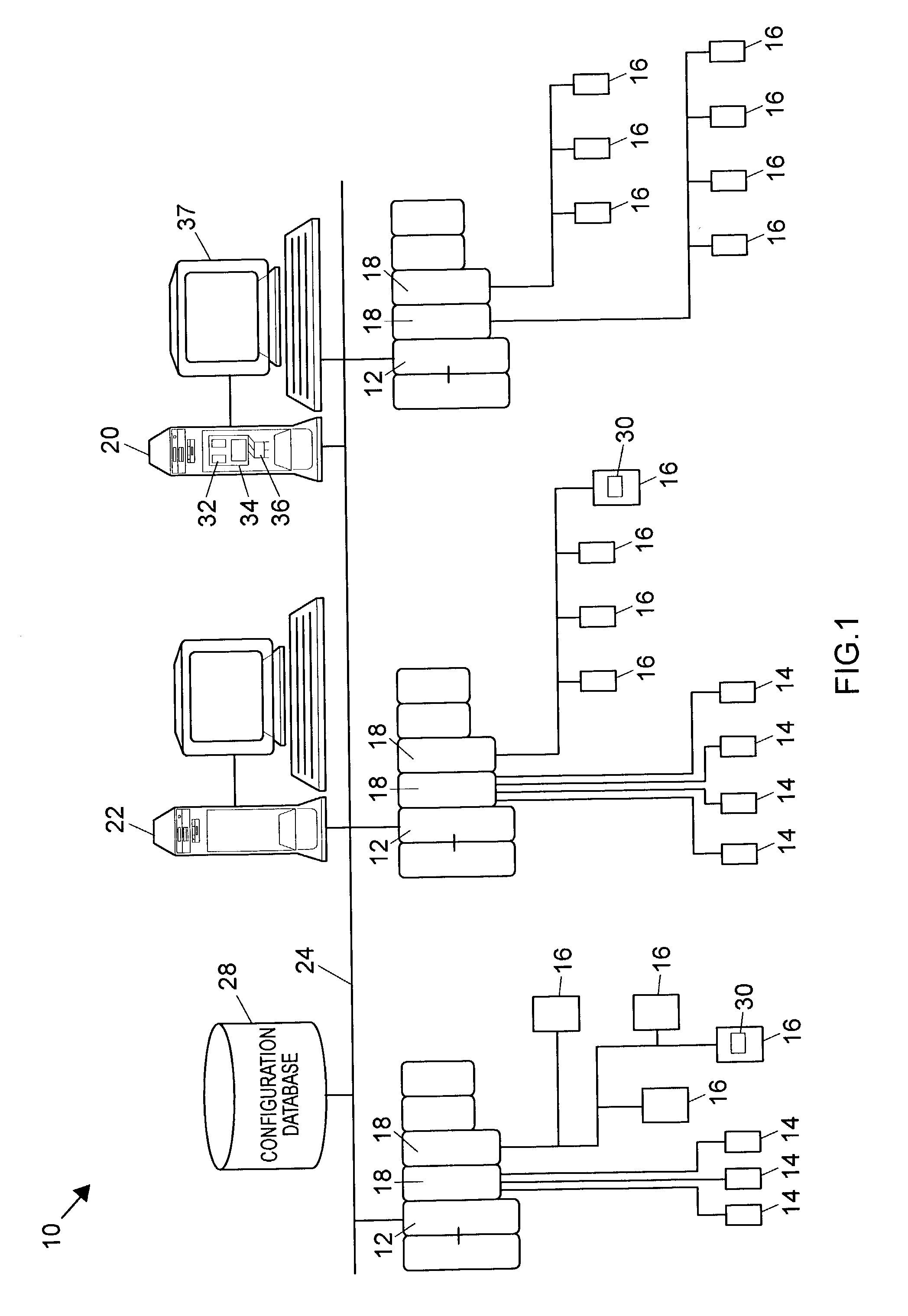

Smart process modules and objects in process plants

InactiveUS7146231B2Good and more complete informationEasy to useSpace heating and ventilationProgram controlOperator interfaceObject composition

An operator interface within a process plant includes an execution engine that implements process flow modules made up of interconnected smart process objects that are aware of devices and other entities within the plant and that can perform methods to detect conditions within the plant, especially on a system-level basis. The smart process objects include a display element to be displayed to the operator, data storage for storing data pertaining to and / or received from an associated entity within a plant, inputs and outputs for communicating with other smart process objects and methods that may be executed on the stored and received data to detect plant conditions, including system-level conditions, such as leaks, errors and other conditions. Process flow modules, which may be made up of numerous interconnected smart process objects, may also include flow algorithms associated therewith to calculate mass balances, flows, etc. for the process elements within the process flow modules.

Owner:FISHER-ROSEMOUNT SYST INC

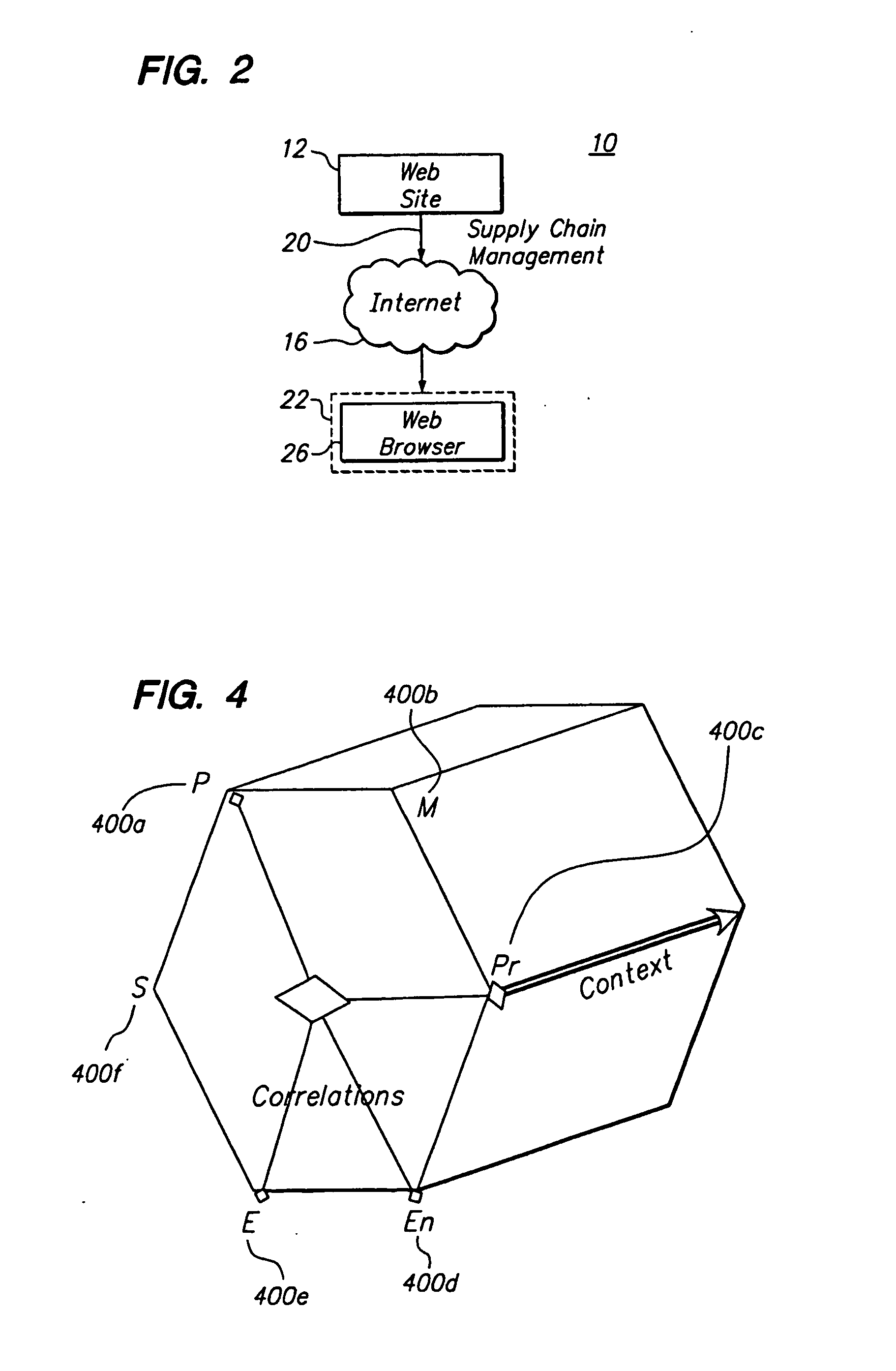

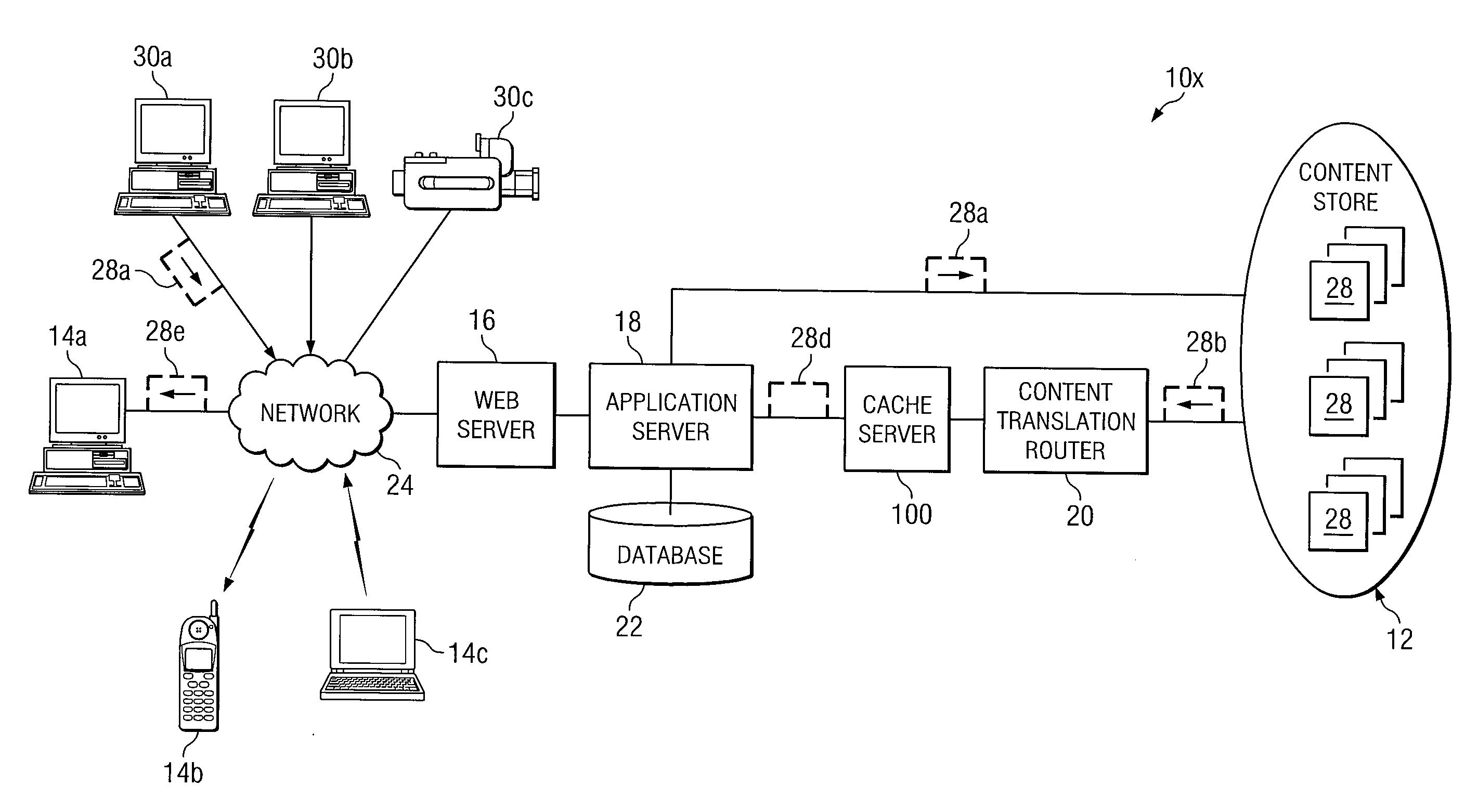

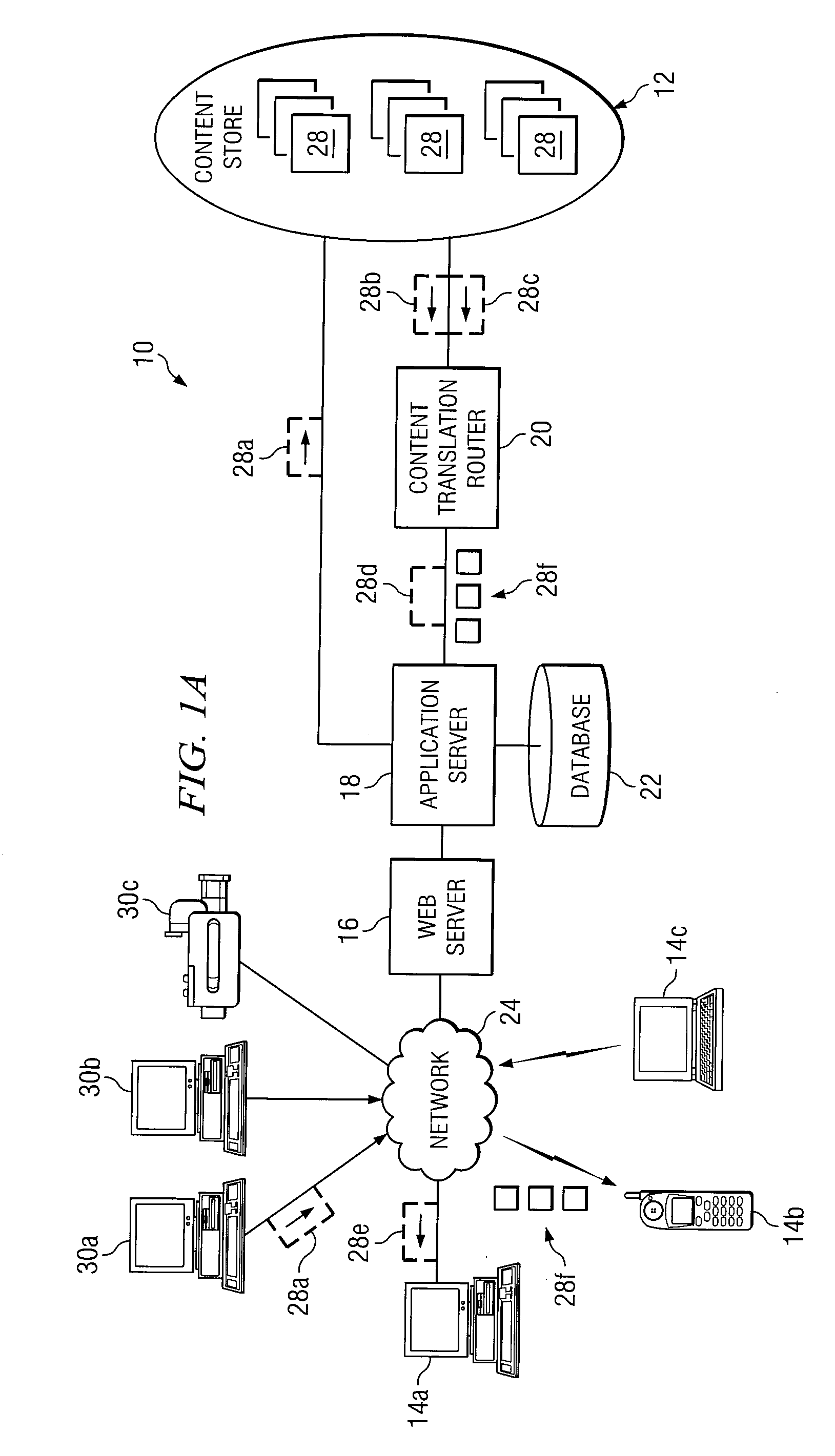

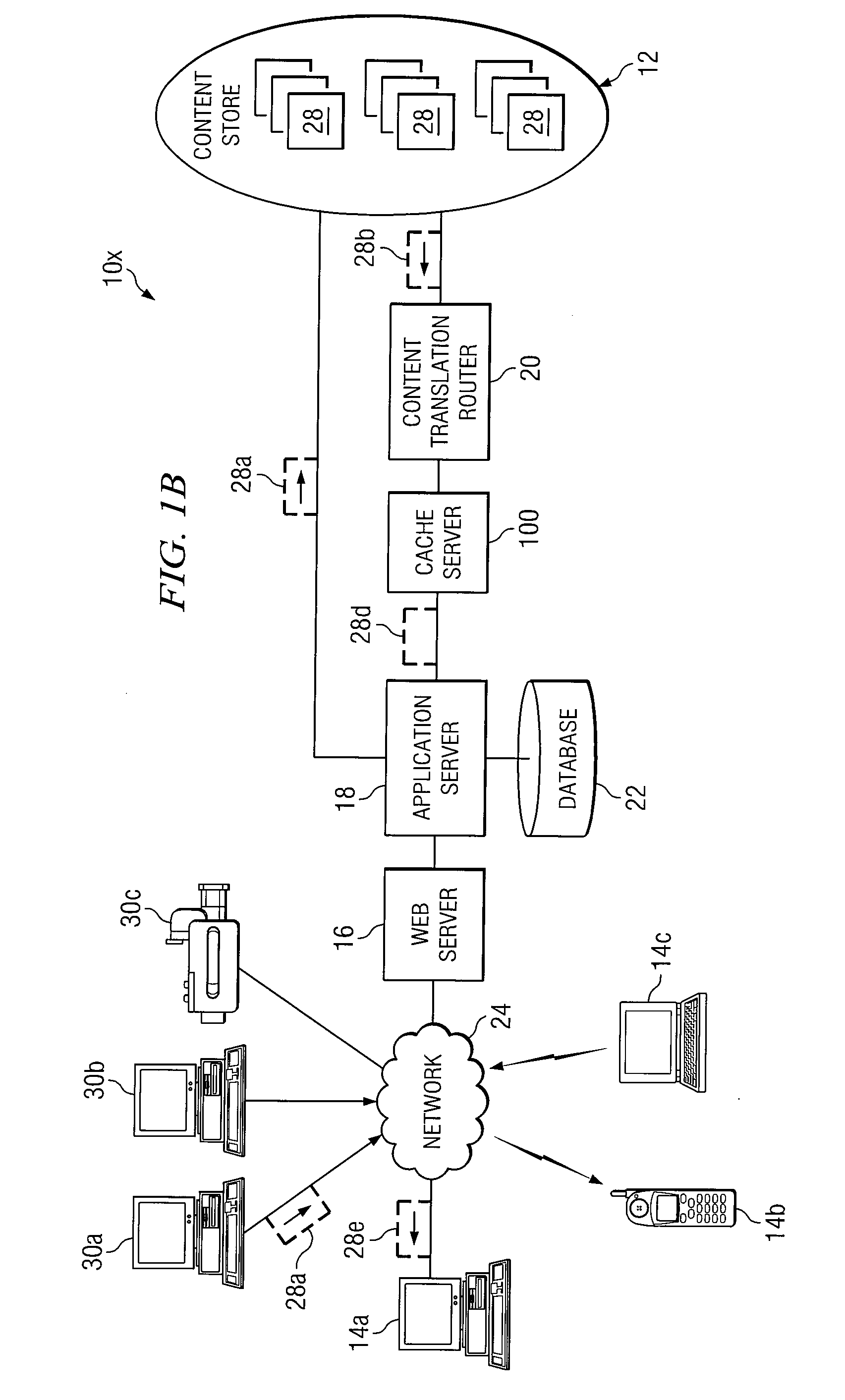

System and method for processing content

ActiveUS20080091845A1Efficiently and effectively managed and storedDelivery reduced eliminatedDigital data information retrievalMultiple digital computer combinationsProcess moduleClient-side

A system for routing media content files having different format characteristics to a plurality of clients over a communication network includes a content translation router. The content translation router is capable of retrieving the content files. In addition, the content translation router includes processing modules for concurrently modifying content files having differing format characteristics to be compatible for transmission over the communication network for viewing at different ones of the clients.

Owner:IMAGINE COMM

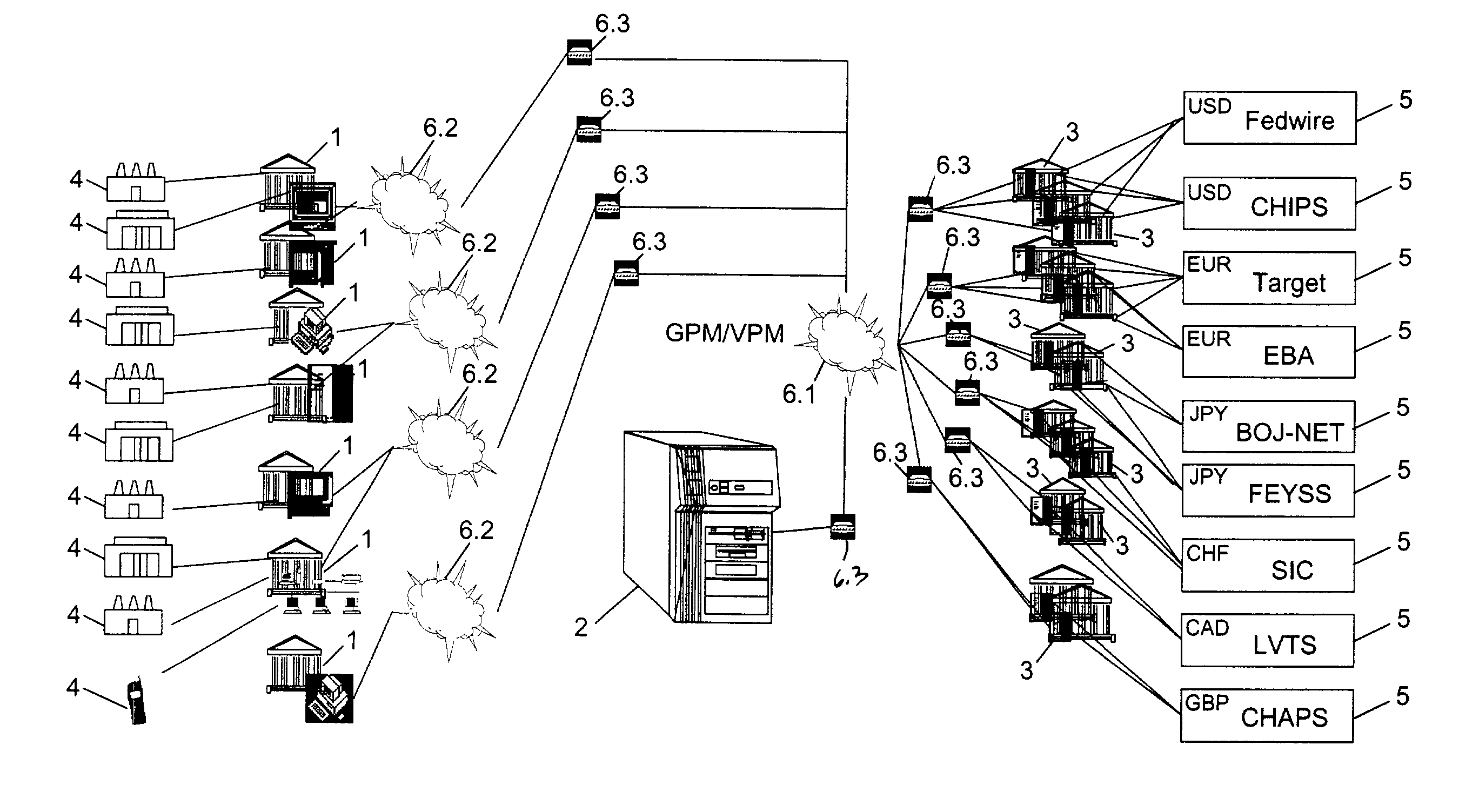

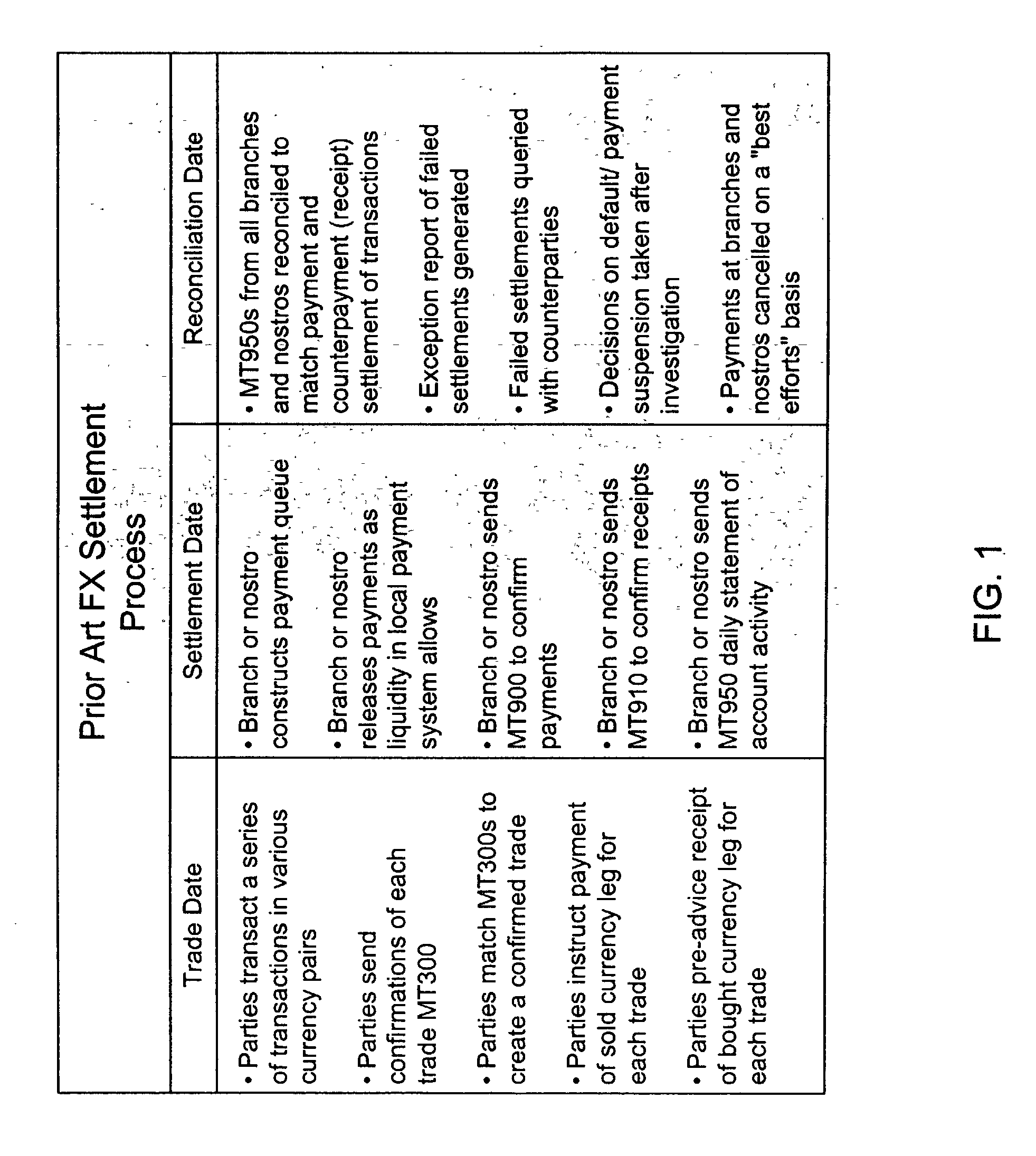

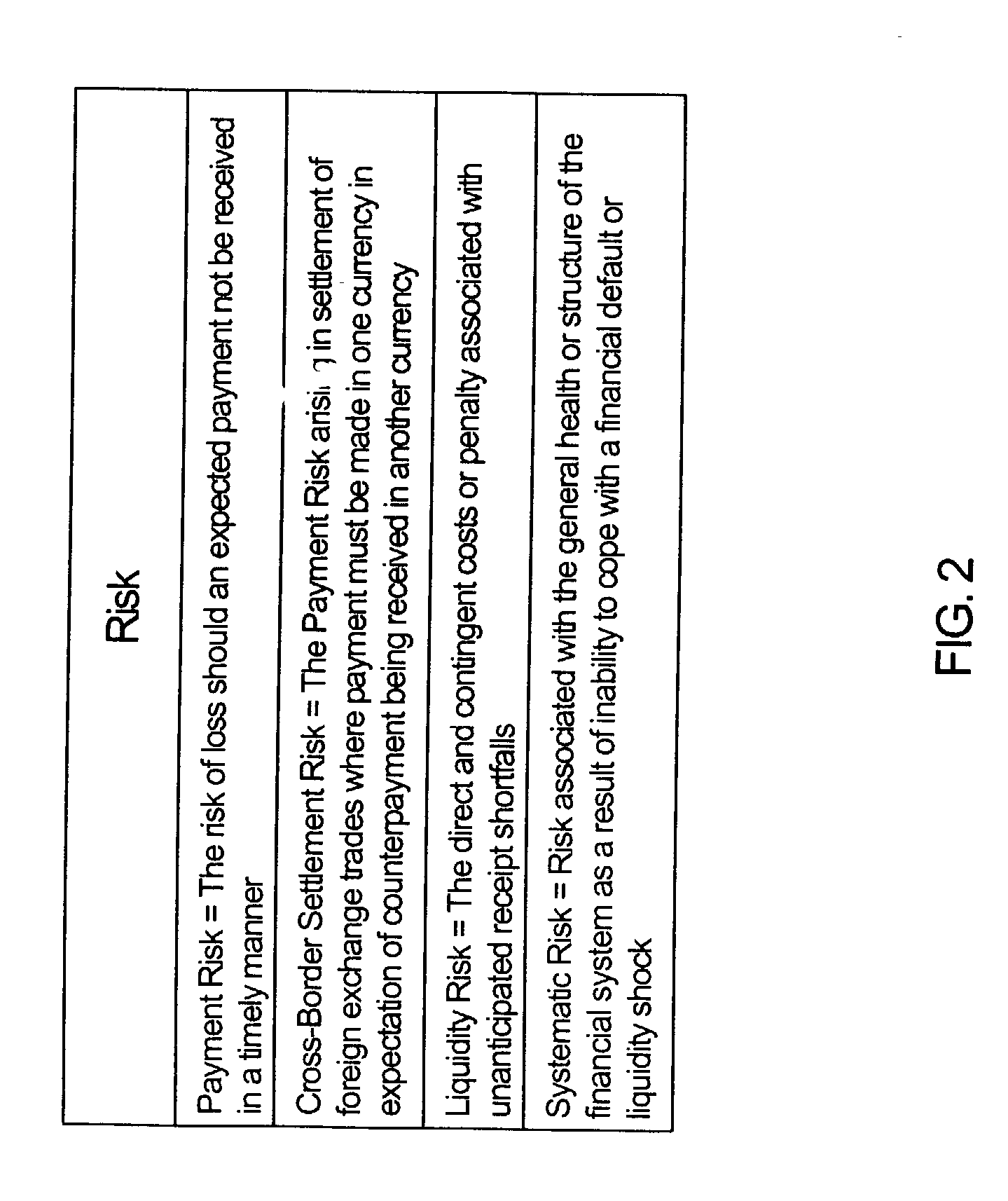

Method of and system for mitigating risk associated with settling of foreign exchange and other payments-based transactions

InactiveUS20020152156A1Improve liquidityFacilitates broad range of communicationFinanceBilling/invoicingPrivate communicationThird party

A real-time, global system and method for controlling payments risk, liquidity risk and systemic risk arising between financial counterparties active in payments-based transactions. The system comprises: a plurality of User Host Applications for use by plurality of Users; a plurality of Third Party Host Applications for use by plurality of Third Parties; and a plurality of Payment Bank Host Applications for use by a plurality of Payment Banks operating a plurality of domestic payment systems. All host applications communicate via cryptographically secure sessions via private communications networks and / or the Internet global computer network. User and Payment Bank access is secured by digital certification. Each Payment Bank Host Application has a mechanism for processing payment messages, including payments instructions to be carried out in its domestic payments system on behalf of a plurality of account holders (including bank correspondents). In addition, each Payment Bank Host Application includes a filter process module for processing payments instructions, prior to being carried out by the domestic payment system. In the event of a counterparty payment failure or insolvency, the Filter Process Module enables instantaneous, automated suspension of all further payments to the counterparty in a multiplicity of chosen currencies on instruction from a Third Party, User or Payment Bank. The filter process module can also be instructed to override risk control parameters to enable payments to proceed regardless for identified transactions, counterparties or intermediaries. All applications improve the availability and timeliness of payments information. The reduction in payments risk and liquidity risk to predetermined tolerances reduces the likelihood of contingent defaults in the event of payment failure due to bank insolvency or other unforeseen event, and thereby reduces systemic risk to the global financial system.

Owner:MIND FUSION LLC

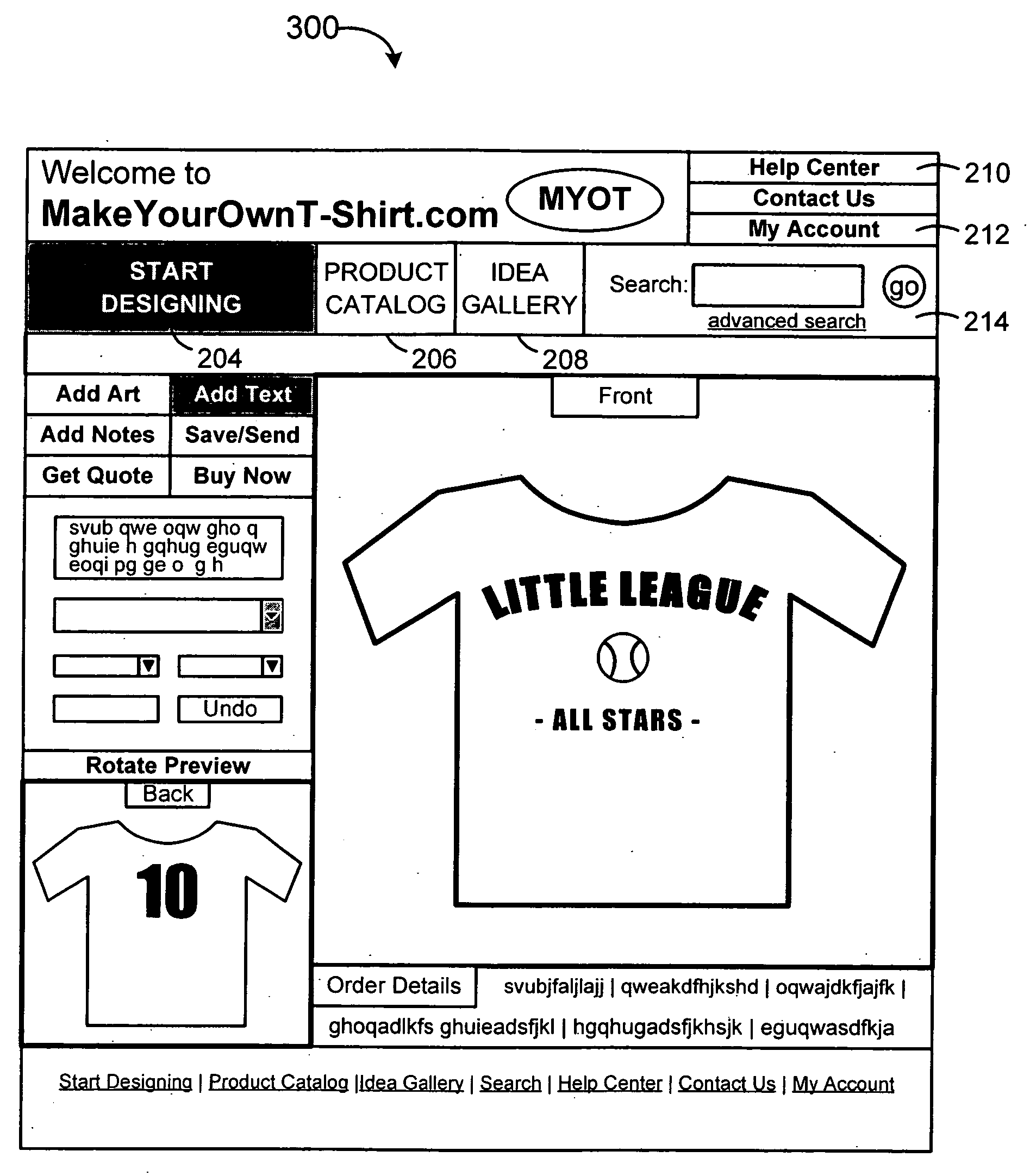

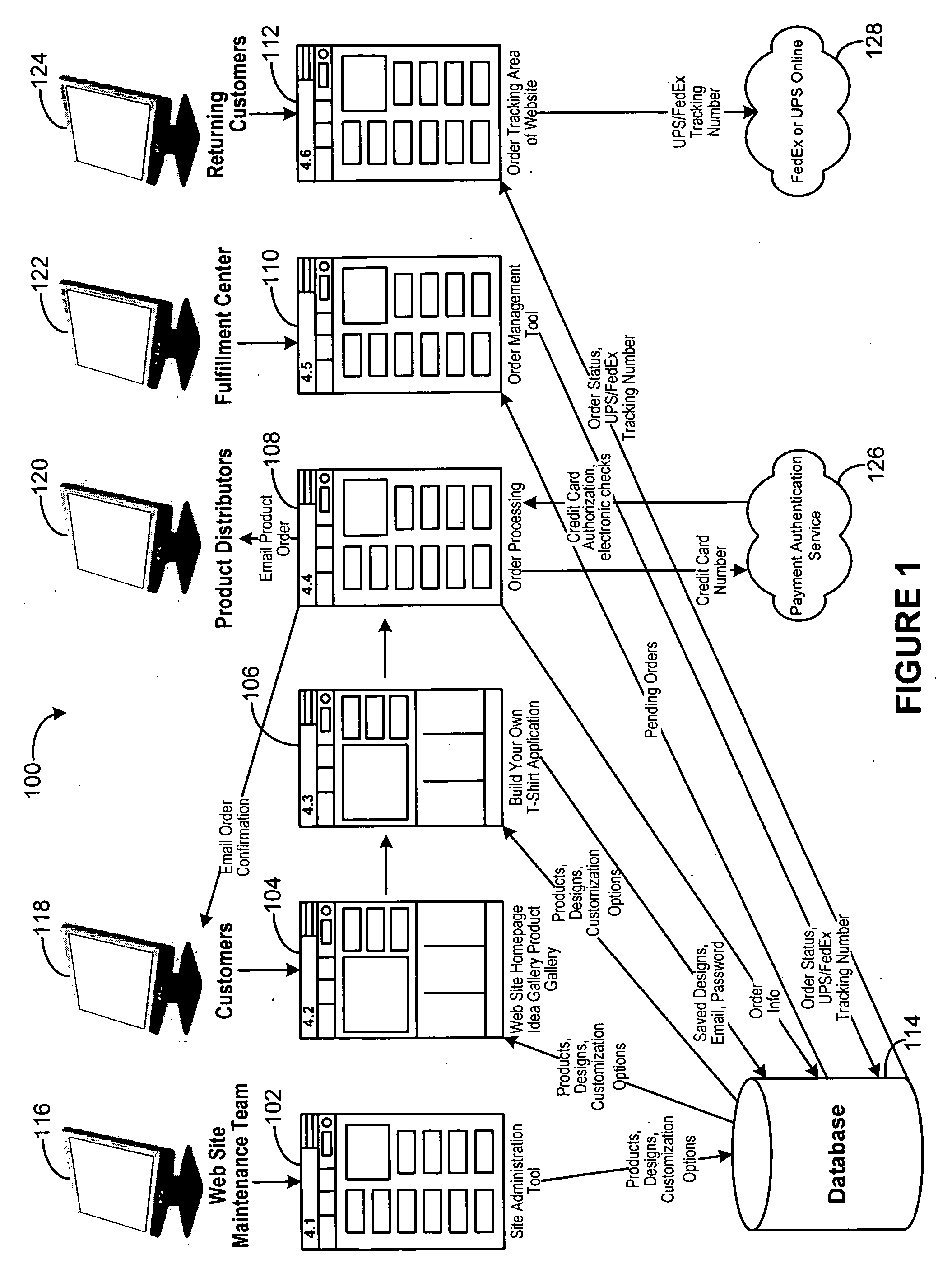

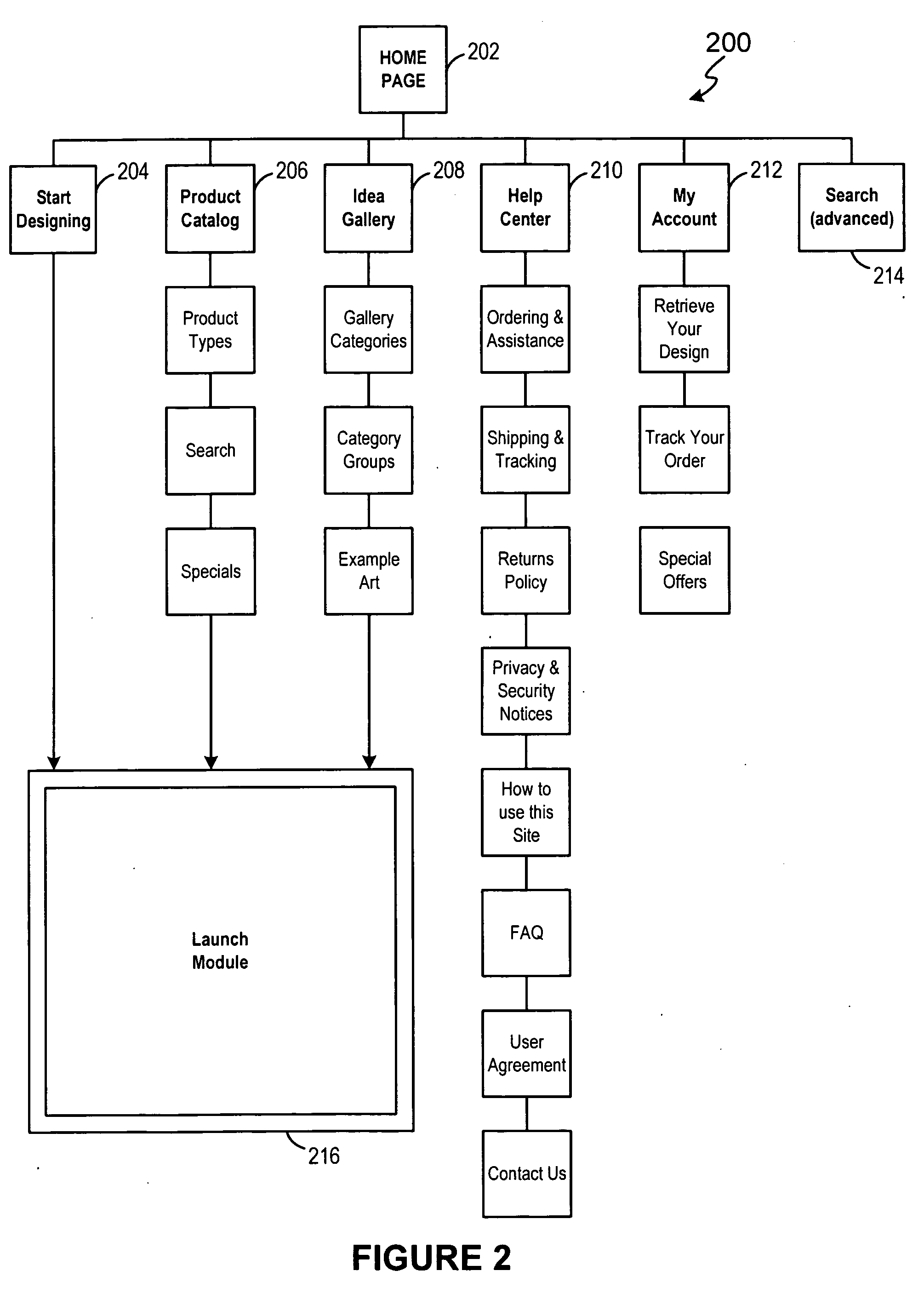

Method and system for customization of consumer products

InactiveUS20050177453A1Create displayBuying/selling/leasing transactionsSpecial data processing applicationsGraphicsManagement tool

A method and system for customization of consumer products, such as the creating, designing and / or selecting of artwork, graphic elements and / or designs for consumer products, are provided. An exemplary method and system can allow for a customer to select, design, save and / or purchase customized products more efficiently, and enable merchandizing and operations personnel to be able to more readily create, approve and publicly display products and related designs without possessing extensive technical capabilities. In accordance with an exemplary embodiment, a system for customization of consumer products can comprise a database configured with a plurality of modules, such as an administration tool module, a home or anchor website module, a customization module, an order processing module, an order management module, and / or an order tracking module. To facilitate a more efficient customization and design process, an exemplary system for customizing consumer products comprises an application configured to use the capabilities of a local computer of the consumer to provide substantially instantaneous design changes and modifications for evaluation by the customer.

Owner:HAVANA CLUB

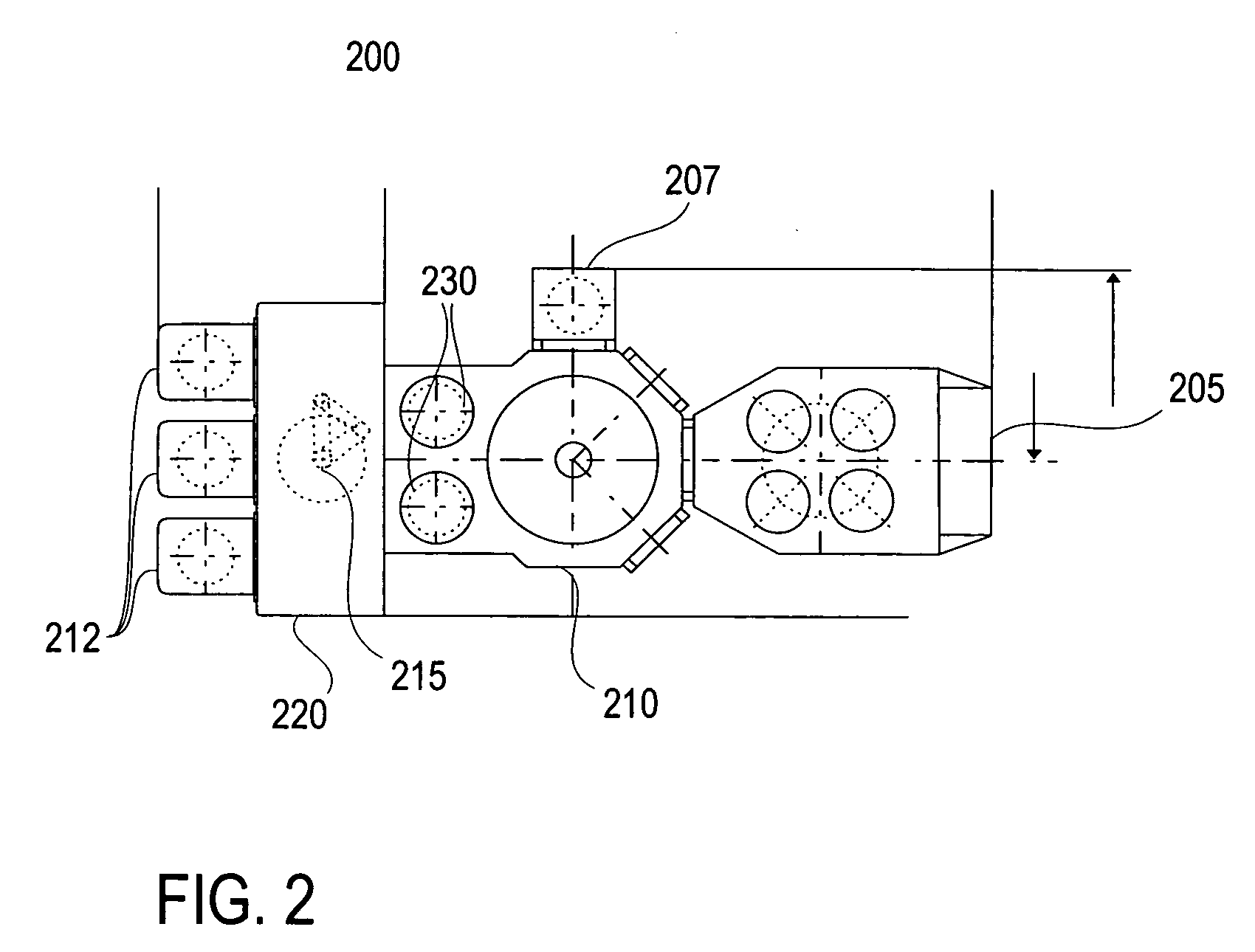

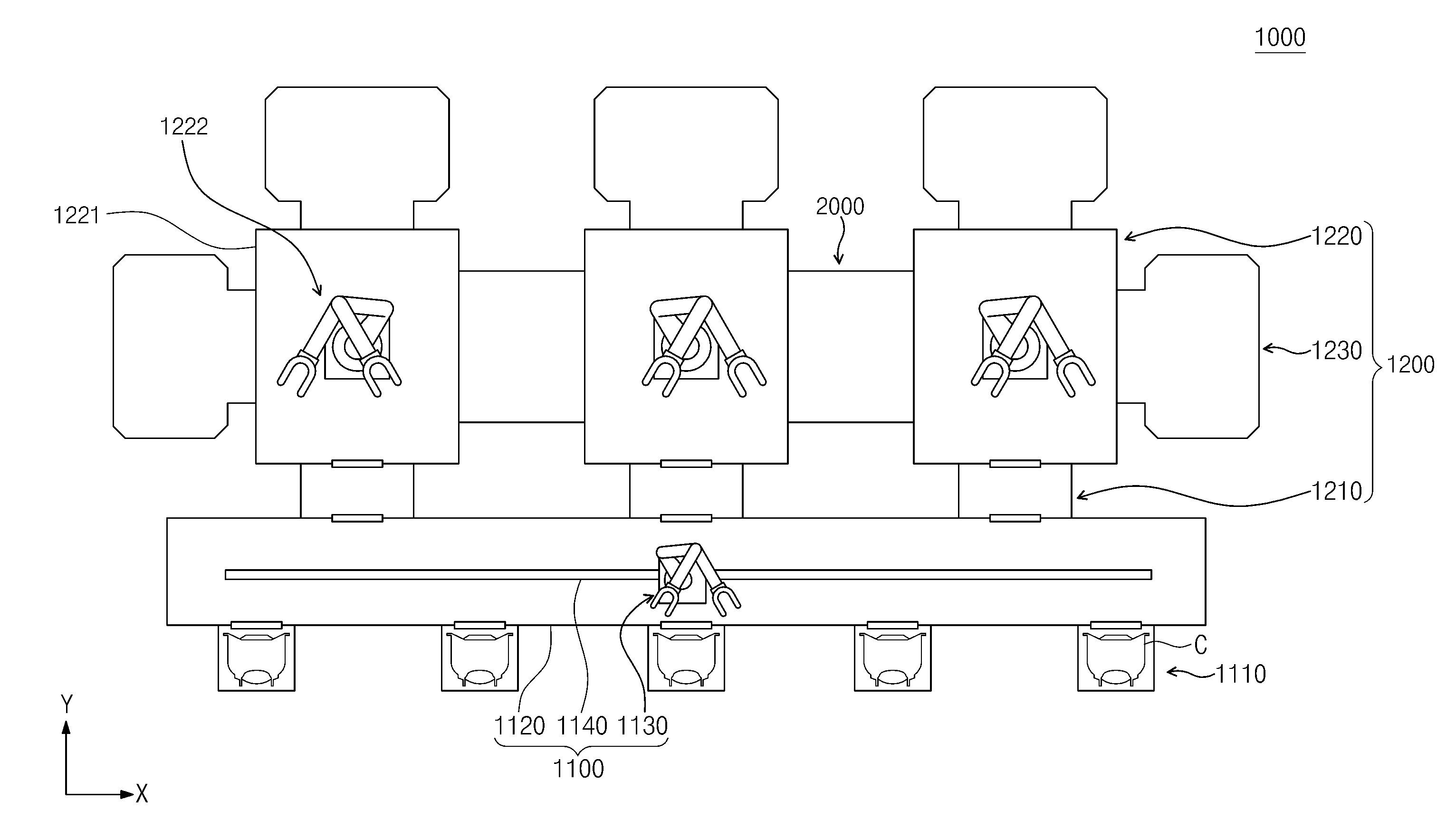

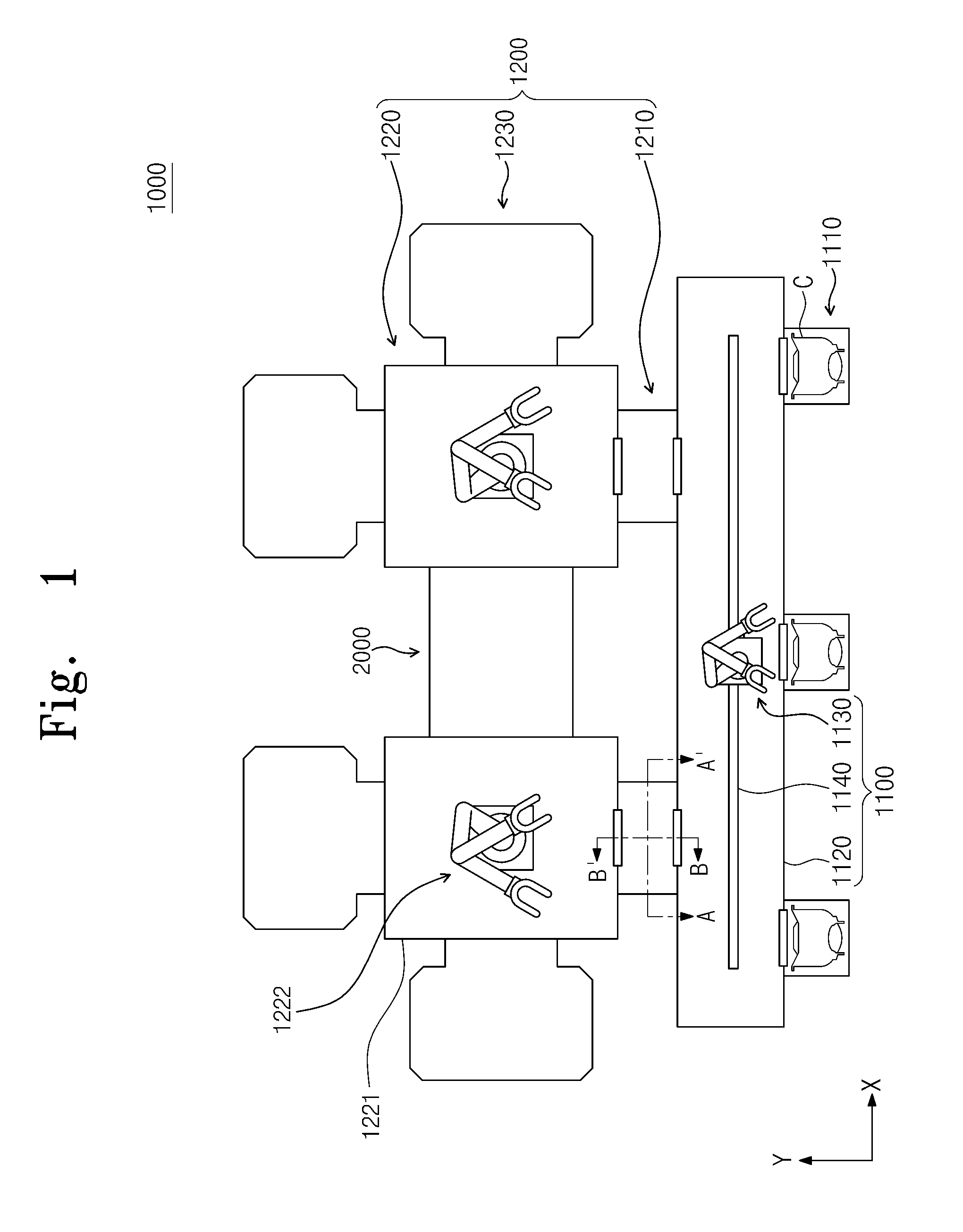

Apparatuses, systems and methods for treating substrate

ActiveUS20130026135A1Minimizes unnecessary carrying of a substrateLiquid surface applicatorsLamination ancillary operationsProcess moduleEngineering

Provided is an apparatus, system and method for treating a substrate, and more particularly, a substrate treating apparatus having a cluster structure, a substrate treating system, and a substrate treating method using the substrate treating system. The substrate treating apparatus includes a load port on which a container containing a substrate is installed, a plurality of process modules treating the substrate, a transfer module disposed between the load port and the process modules, and transferring the substrate between the container and the process modules, and a buffer chamber disposed between neighboring ones of the process modules, and providing a space for carrying the substrate between the neighboring process modules.

Owner:SEMES CO LTD

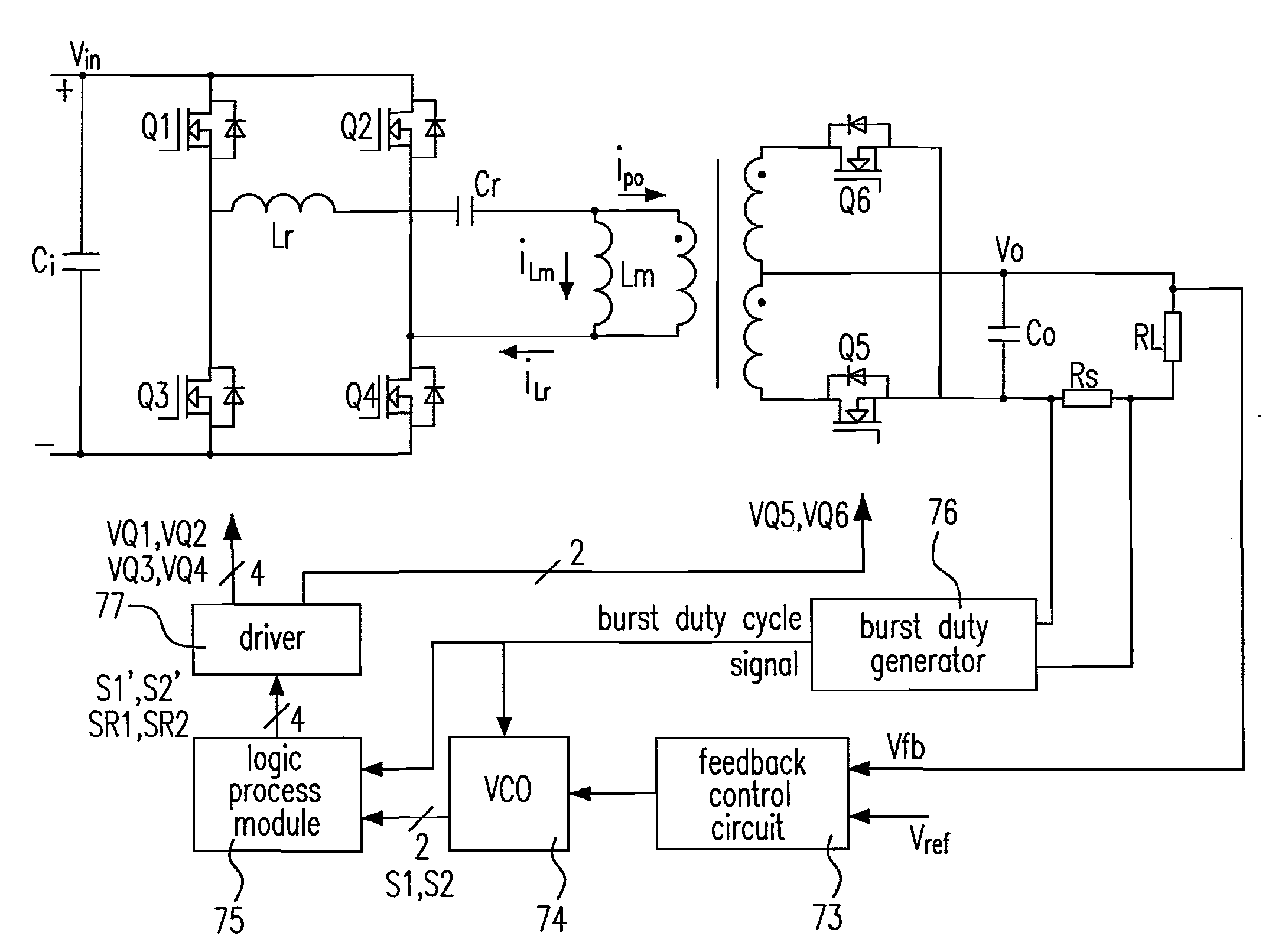

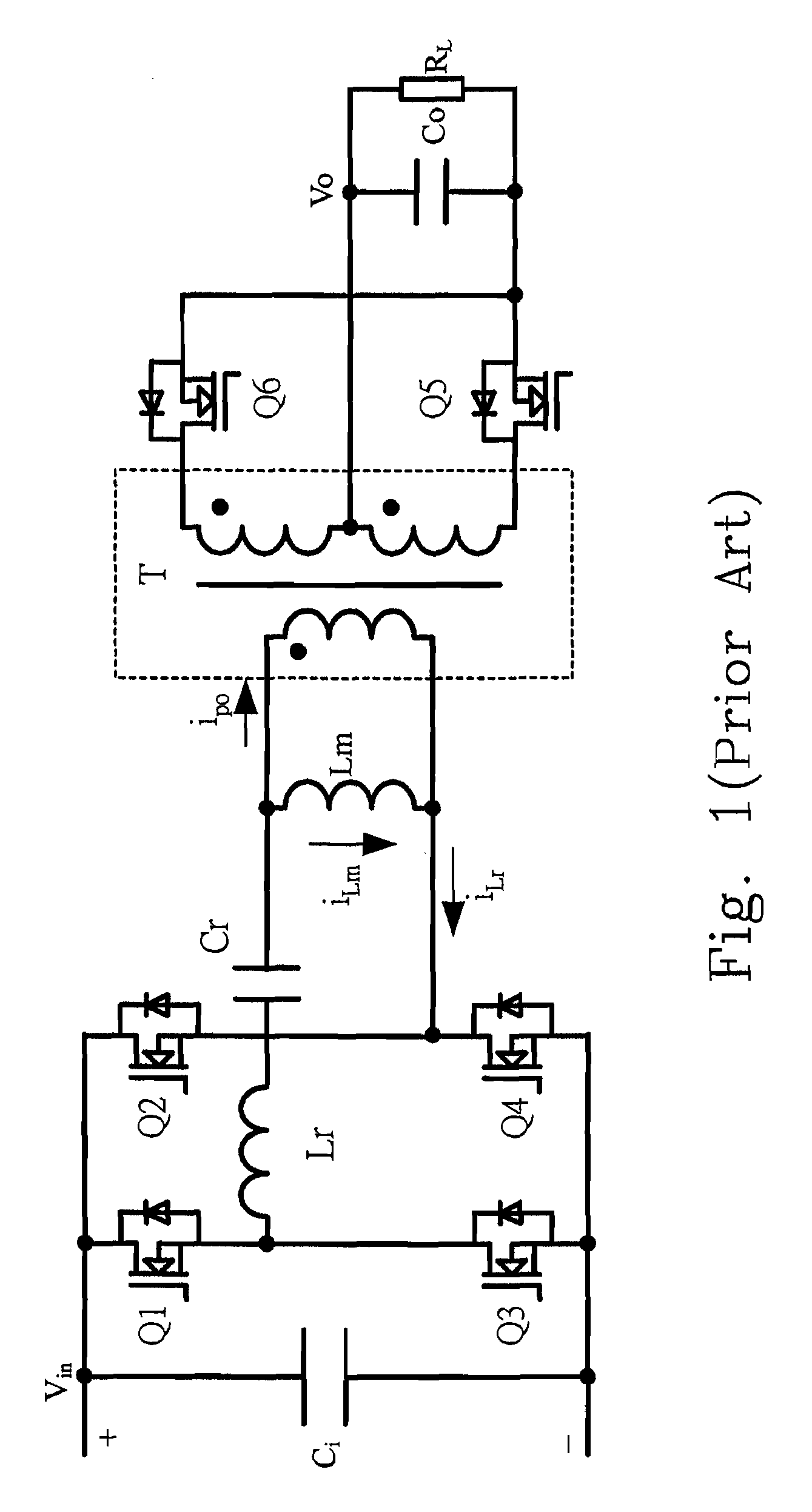

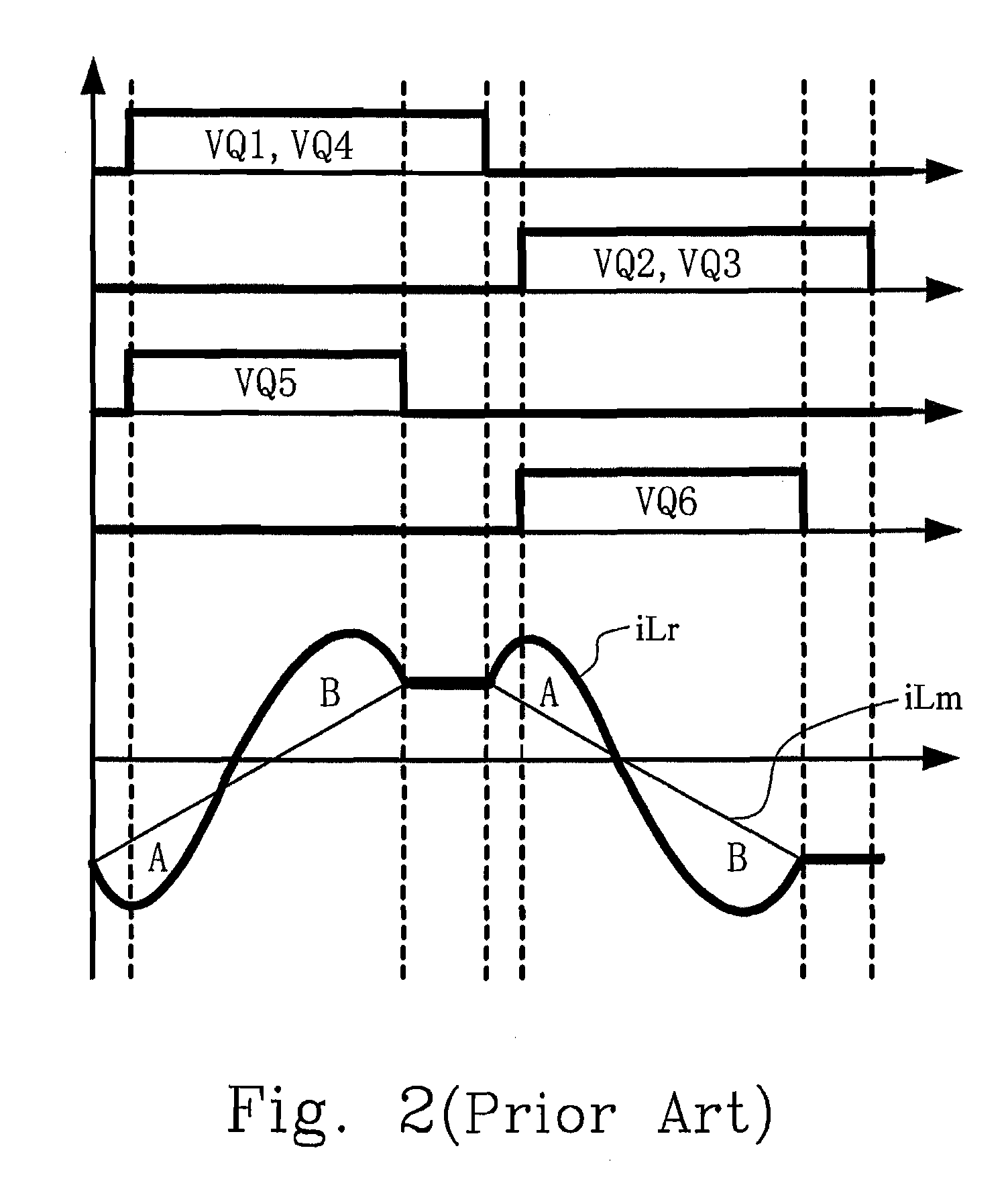

Synchronous rectification circuit having burst mode controller and controlling method thereof

ActiveUS20090244934A1Improve light load efficiencyReduce lossesEfficient power electronics conversionDc-dc conversionProcess moduleMode control

The configuration of a synchronous rectification circuit and a controlling method thereof are provided. The proposed circuit includes a converter including a first switch and a first synchronous rectifier, and a burst mode controller including a logic process module performing one of functions of delaying one of a non-integer and at least one operating periods to generate a synchronous rectification driving signal of the first synchronous rectifier counting from a beginning of a first pulse of a driving signal of the first switch during a working time of a burst period, and turning off the synchronous rectification driving signal of the first synchronous rectifier by one of the non-integer operating period and the at least one operating period ahead of an ending of a last operating period of the driving signal of the first switch during the working time of the burst period.

Owner:DELTA ELECTRONICS INC

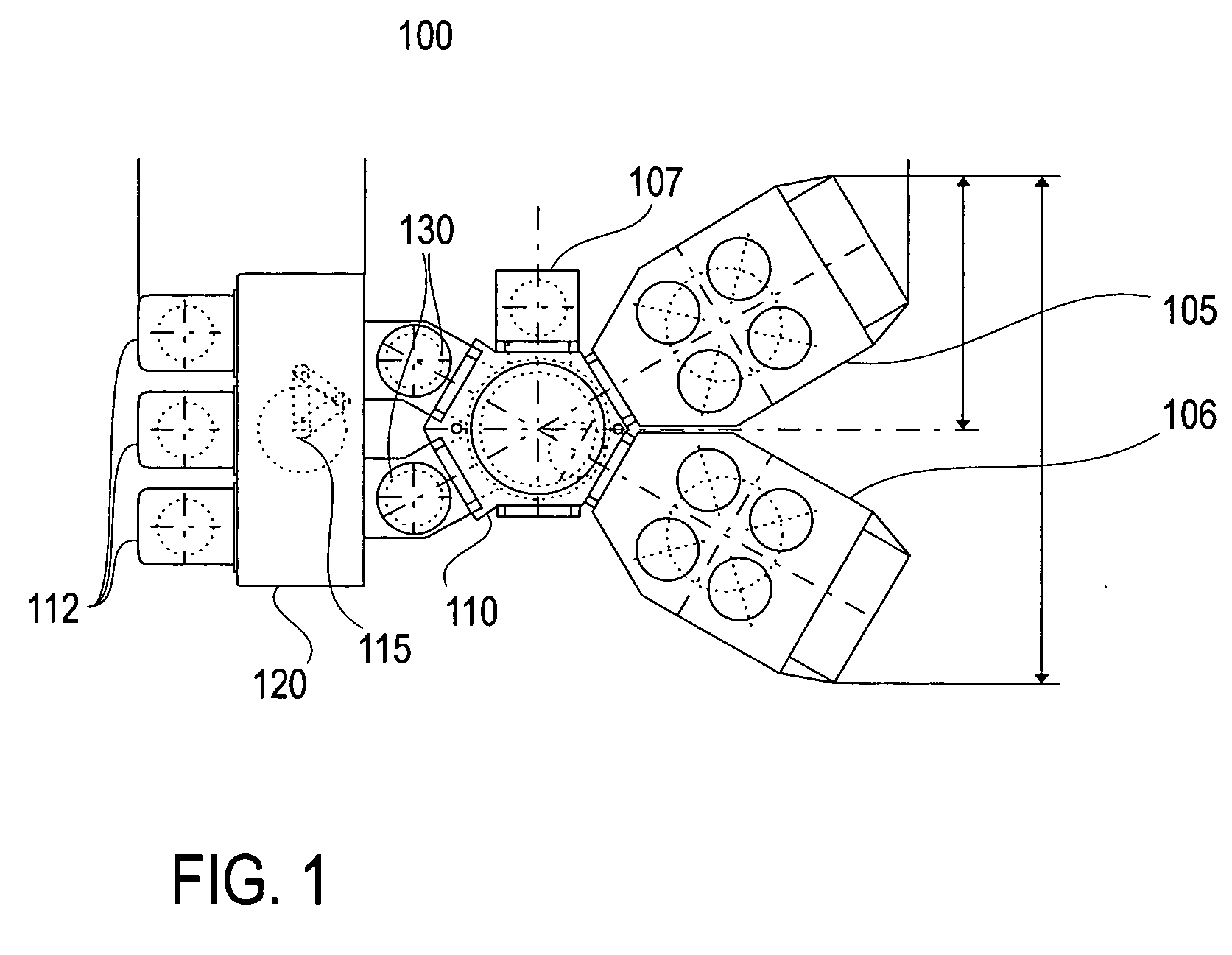

Linear substrate transport apparatus

Substrate processing apparatus having a chamber, a generally linear array of process modules, a substrate transport, and a drive system. The chamber is capable of being isolated from the outside atmosphere. Each process module of the array is communicably connected to the chamber to allow a substrate to be transferred between the chamber and process module. The substrate transport is located in and is movably supported from the chamber. The transport is capable of moving along a linear path defined by the chamber for transporting the substrate between process modules. The drive system is connected to the chamber for driving and moving the transport along the linear path. The chamber comprises a selectable number of chamber modules serially abutted to defined the chamber. Each module has an integral portion of the drive system.

Owner:BOOKS AUTOMATION US LLC

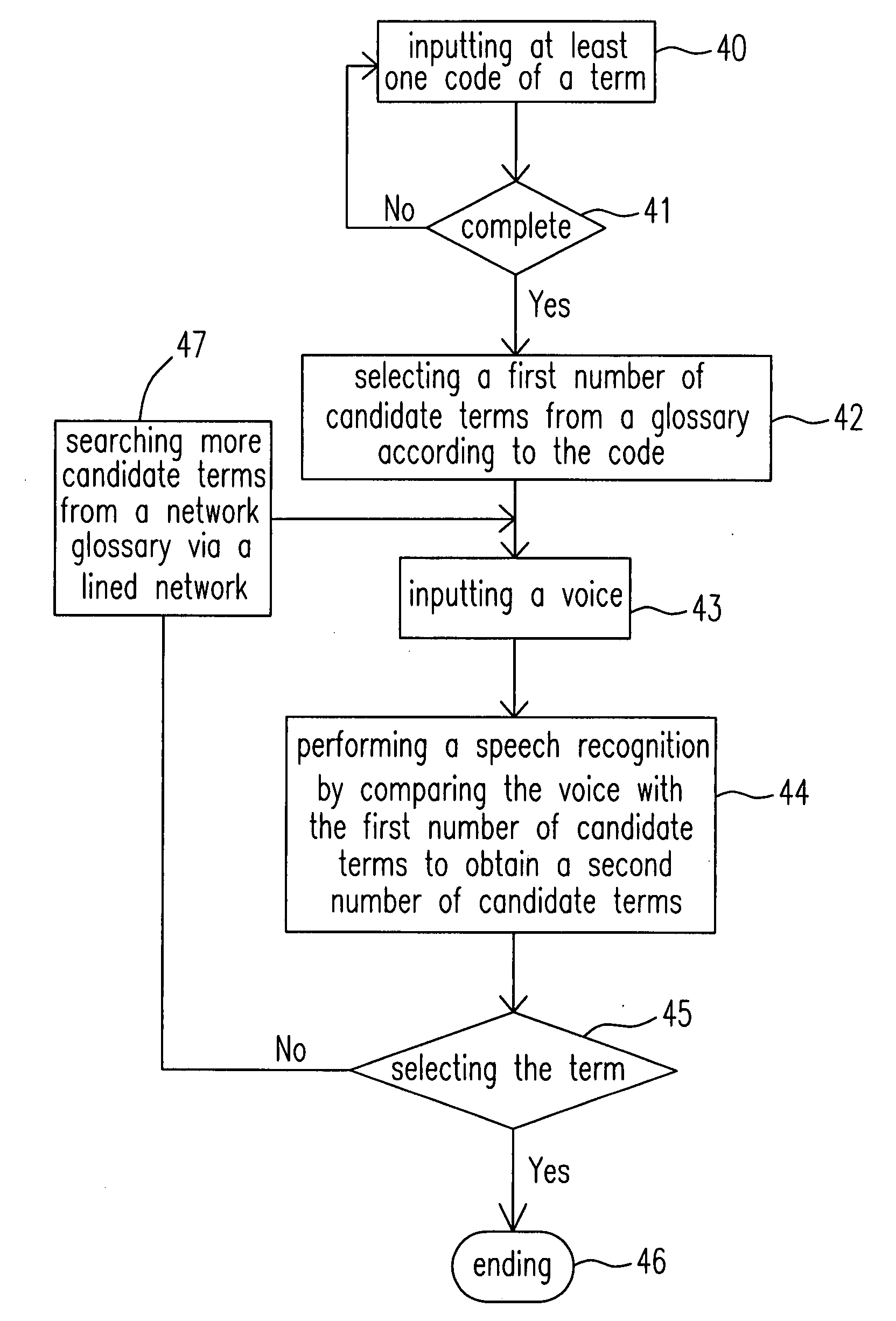

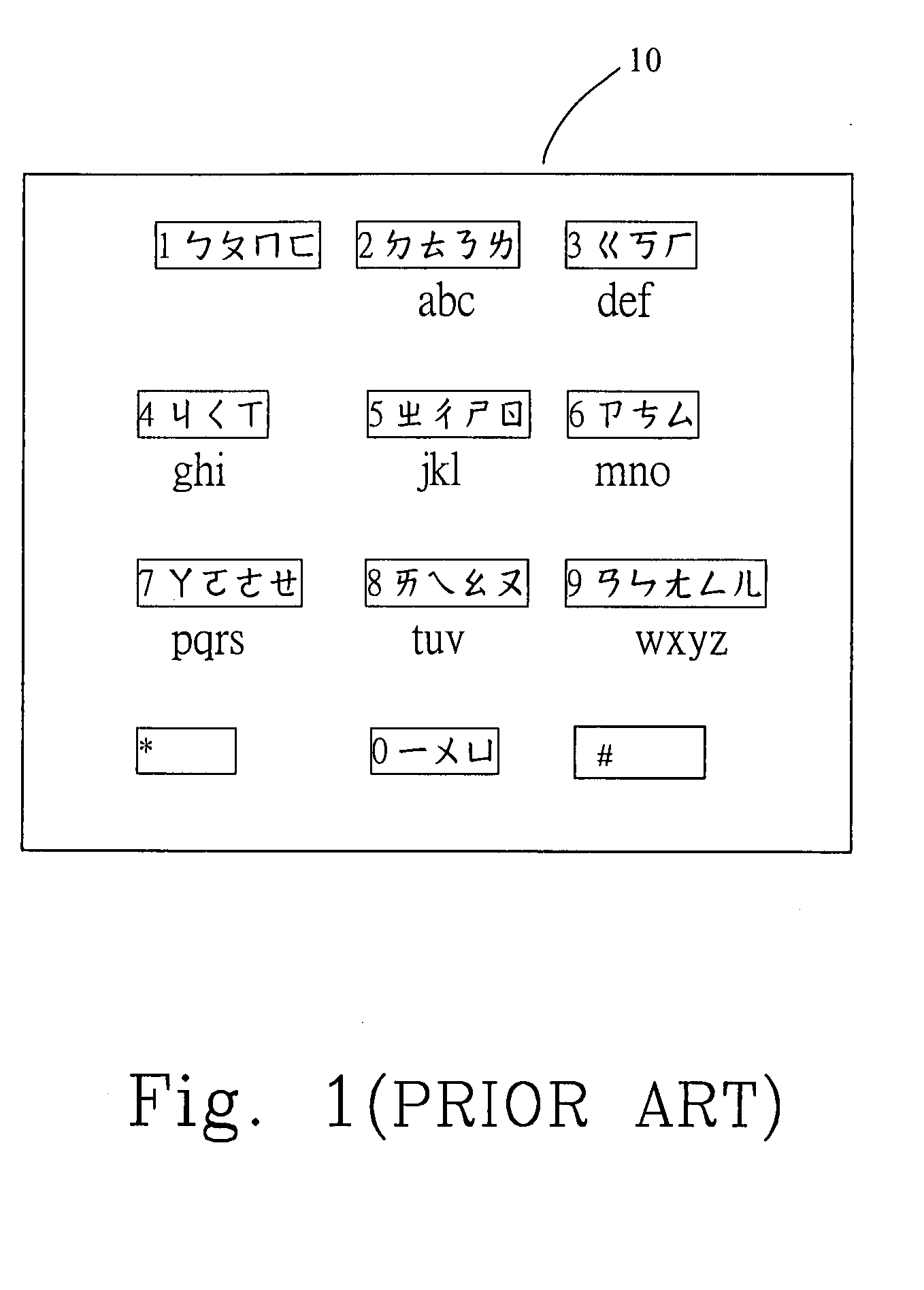

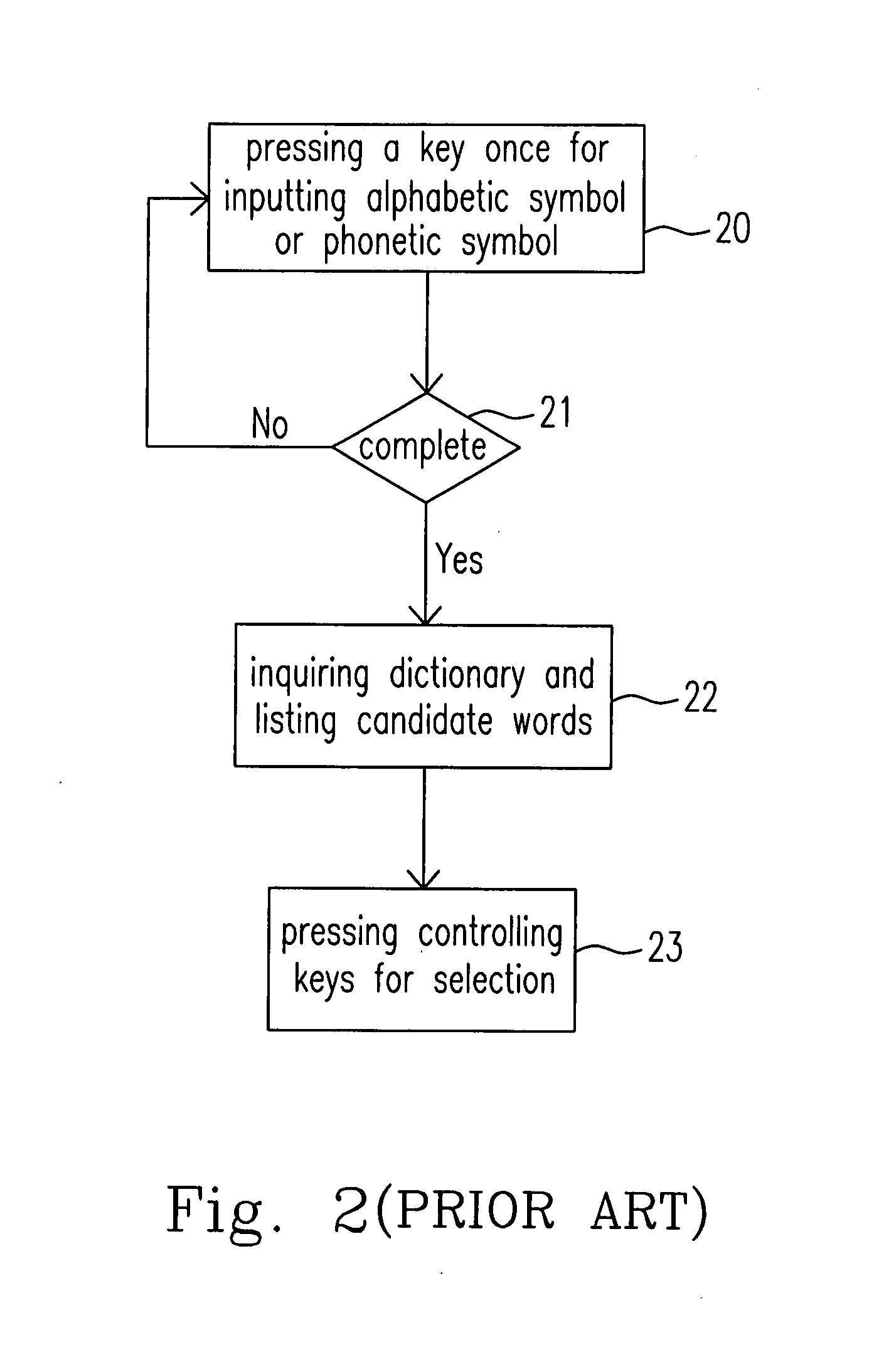

Input system for mobile search and method therefor

InactiveUS20080281582A1Decrease keying numberThe process is convenient and fastDigital data processing detailsNatural language data processingMobile searchProcess module

An input system for mobile search and a method therefor are provided. The input system includes an input module receiving a code input for a specific term and a voice input corresponding thereto, a database including a glossary and an acoustic model, wherein the glossary includes a plurality of terms and a sequence list, and each of the terms has a search weight based on an order of the sequence list, a process module selecting a first number of candidate terms from the glossary according to the code input by using an input algorithm and obtaining a second number of candidate terms by using a speech recognition algorithm to compare the voice input with the first number of candidate terms via the acoustic model, wherein the second number of candidate terms are listed in a particular order based on their respective search weights, and an output module showing the second number of candidate terms in the particular order for selecting the specific term therefrom.

Owner:DELTA ELECTRONICS INC

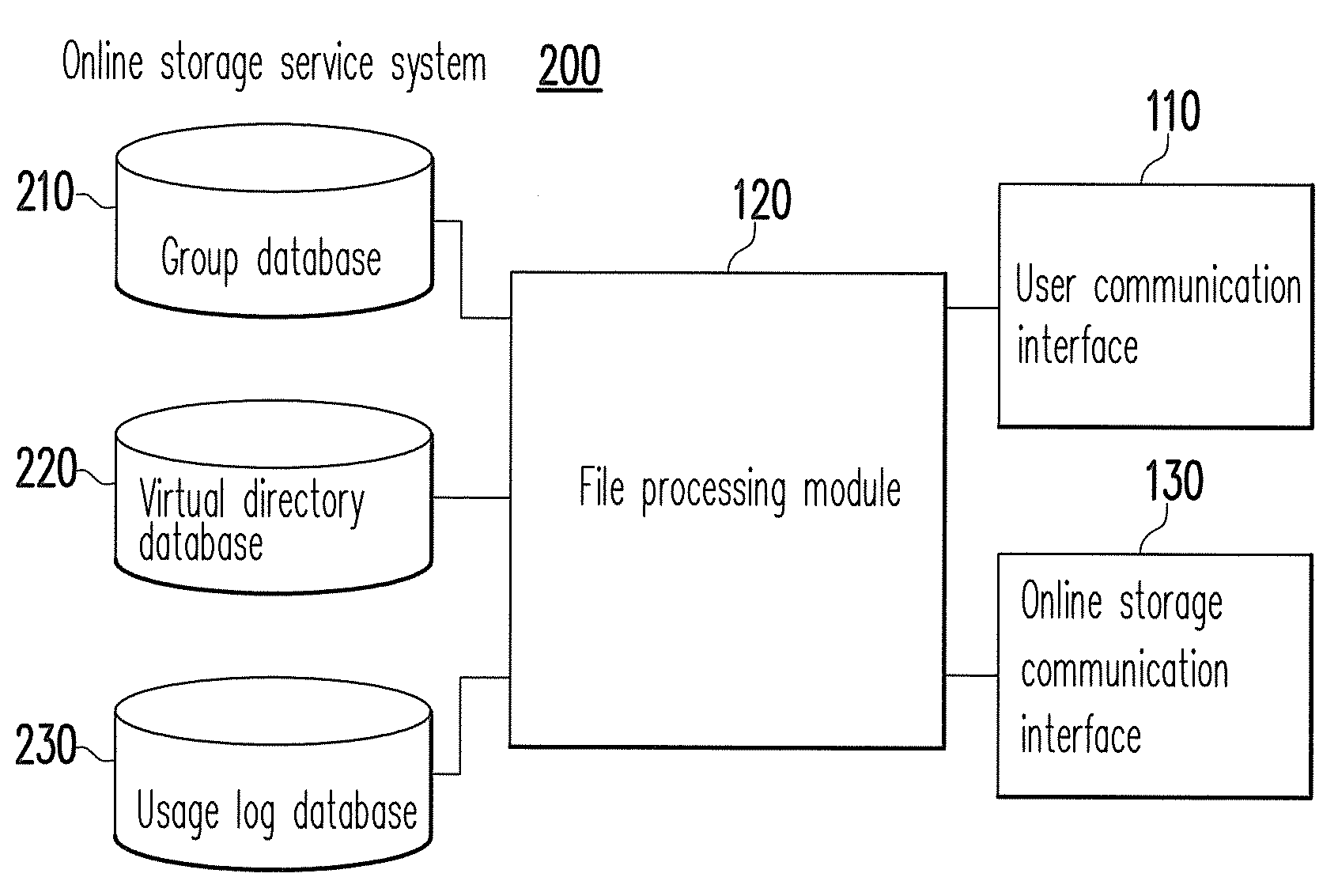

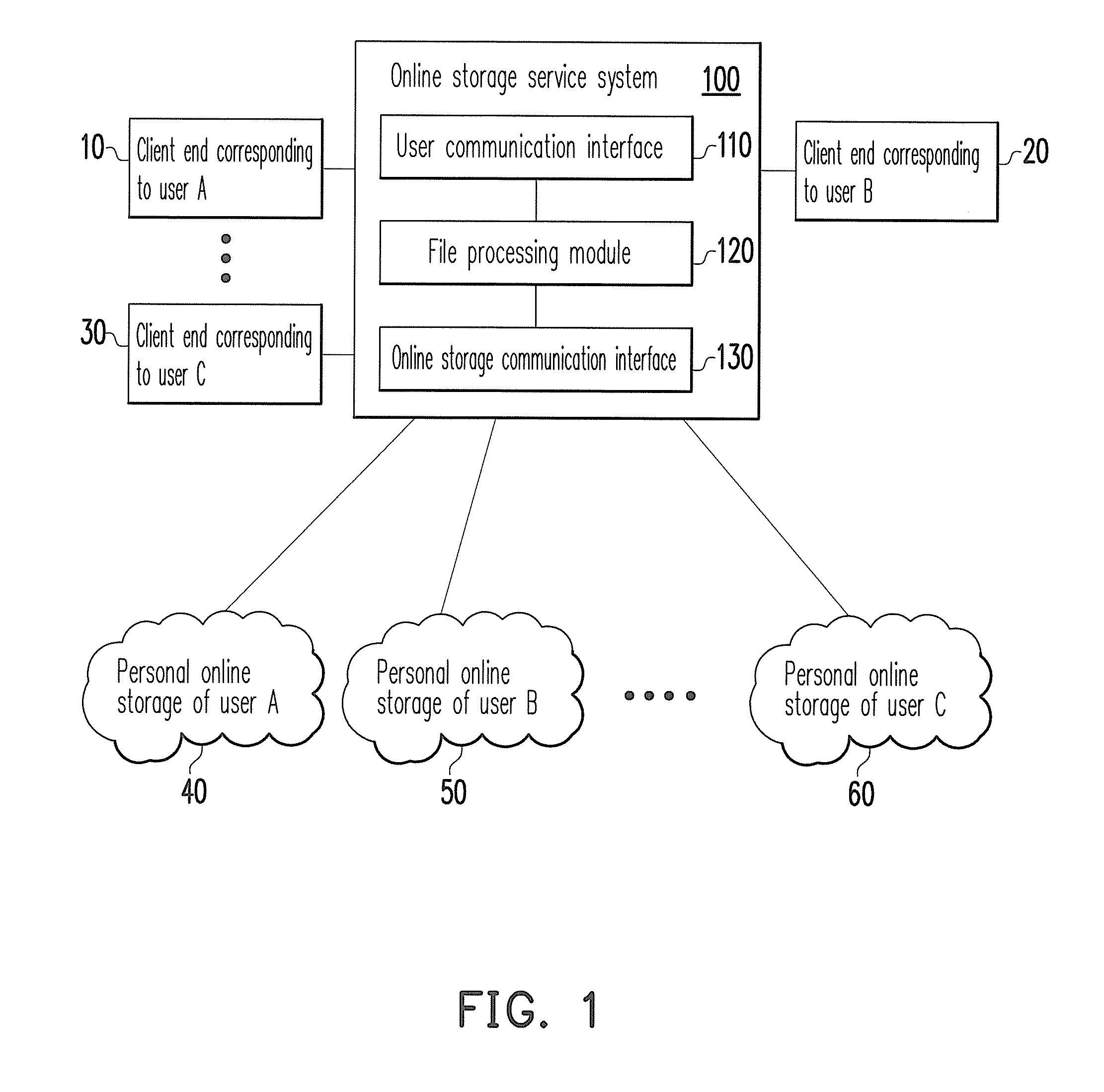

System and method for sharing online storage services among multiple users

InactiveUS20120110005A1Increase flexibilityImprove reliabilityDigital data information retrievalDigital data processing detailsCommunication interfaceProcess module

A system and a method for sharing online storage services among multiple users are provided. The system includes a user communication interface, a file processing module, and an online storage communication interface. The user communication interface is configured to connect to a client end corresponding to a first user. When the user communication interface receives a file upload request and a corresponding upload file from the client end, the file processing module searches for a personal online storage of the first user and a shared online storage of at least one related user of the first user and determines to upload the upload file to a partial online storage of the personal online storage and the shared online storage. The online storage communication interface transfers the upload file to the partial online storage determined by the file processing module.

Owner:INSTITUTE FOR INFORMATION INDUSTRY

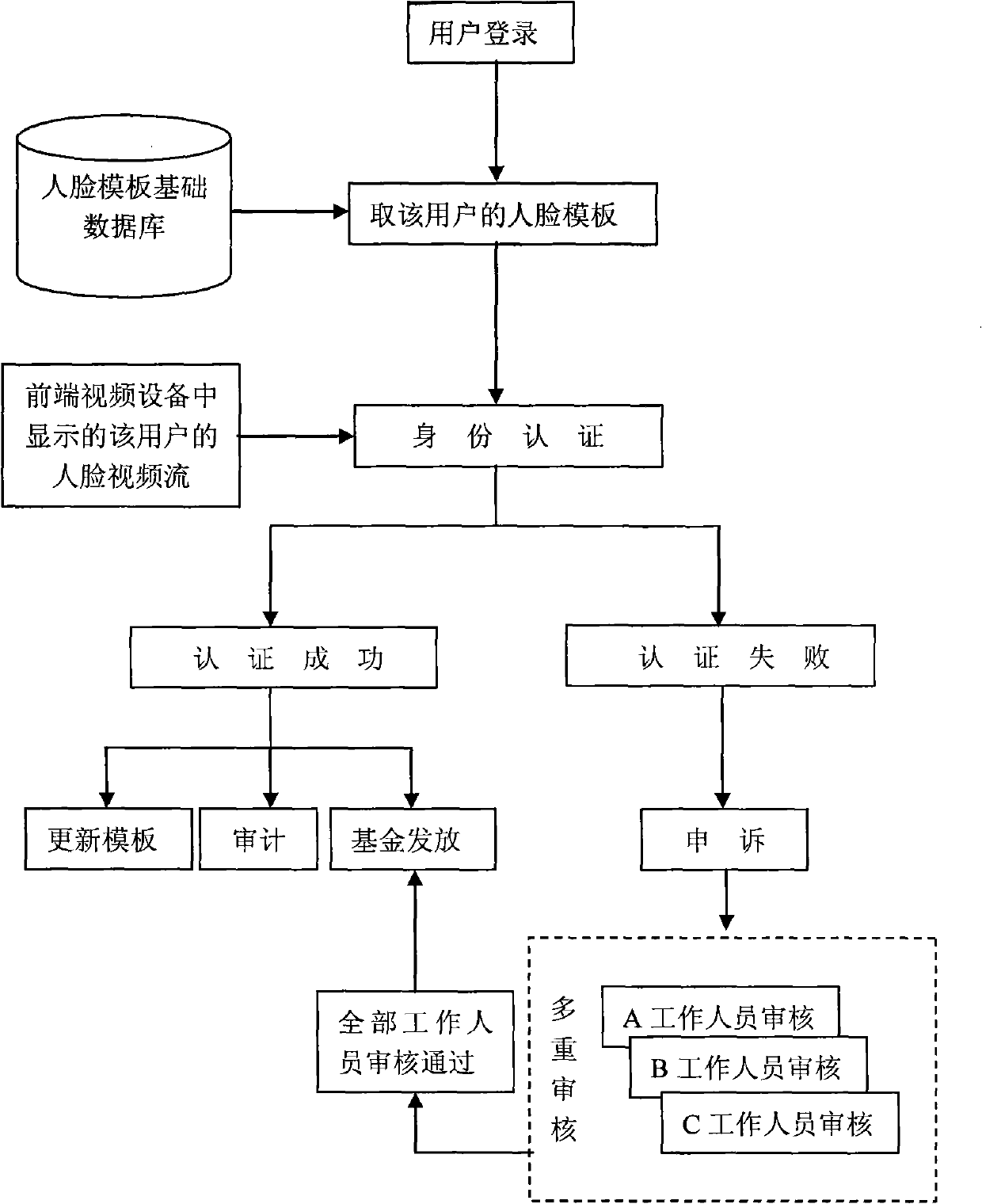

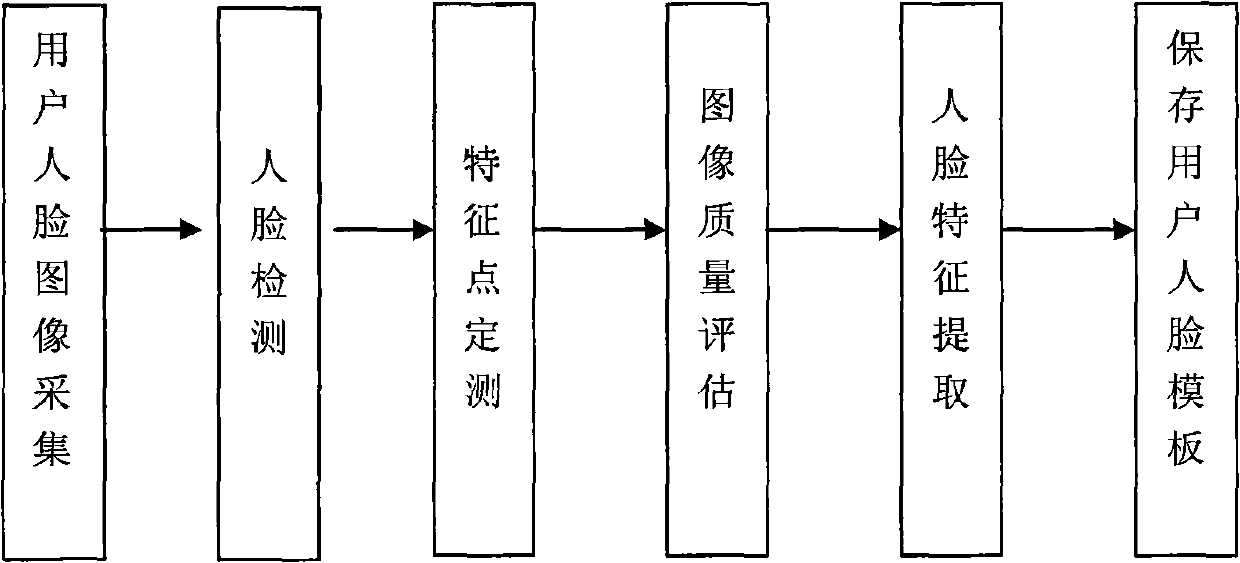

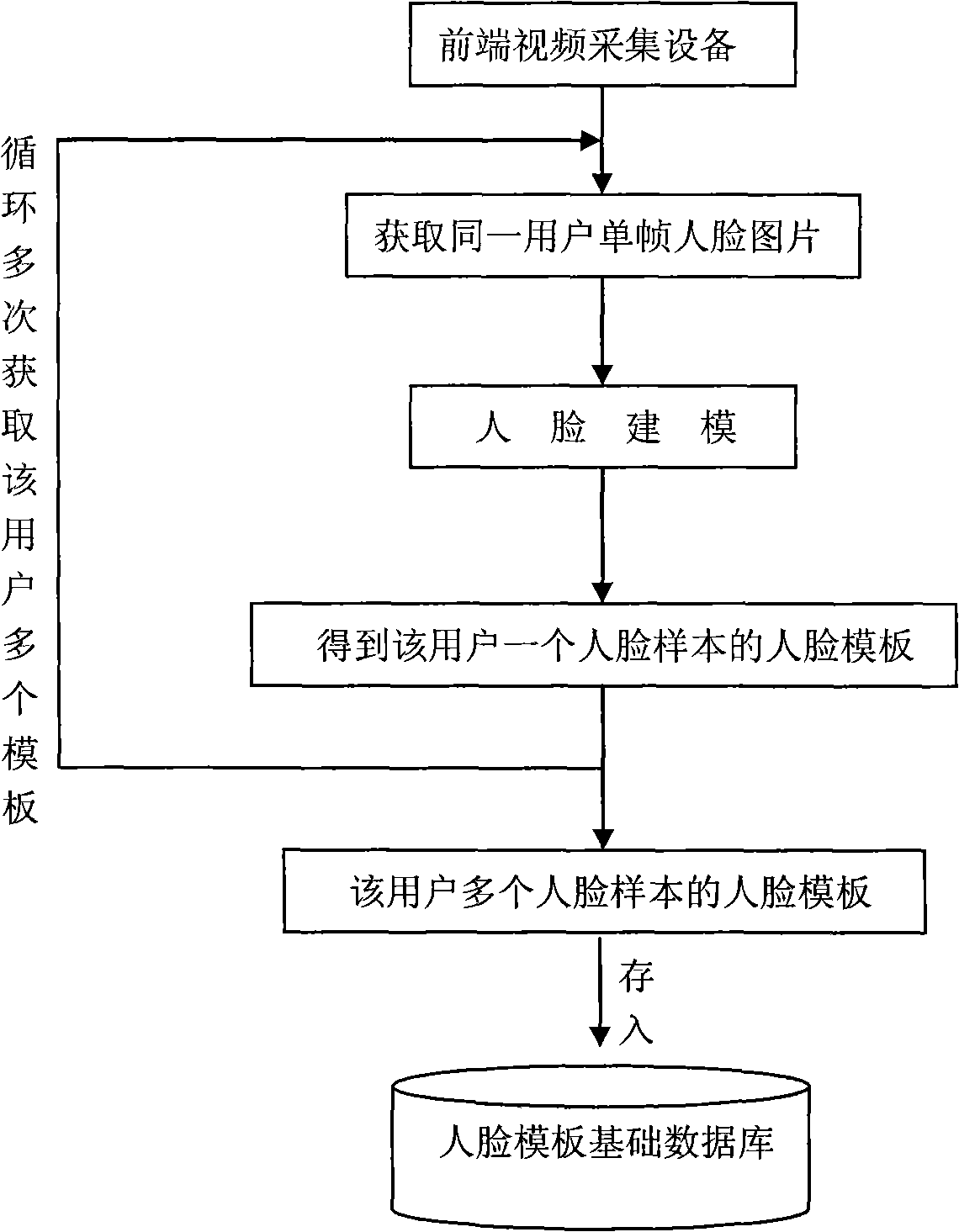

Social insurance identity authentication method based on face recognition and living body detection

InactiveCN101770613AEfficiently buildPrevent counterfeitingFinanceCharacter and pattern recognitionProcess moduleTemplate based

The invention relates to a social insurance identity authentication method based on face recognition and living body detection, which comprises implementation steps as follows: a face template base database is established and a social insurance user logs on to an identity authentication module which completes the combination of face recognition and living body detection,, a face template online update module, an audit query module, a complaint processing module and a multiple auditing module. The authentication method runs in the following way that: a user logins to generate a face template of the user, the identity authentication module which combines face recognition and living body detection is used to perform identity authentication of face video streams of the user displayed in a front-end video device; if authentication succeeds, auditing is performed while updating the template, and social insurance fund is issued; if authentication fails, a complaint program is used for multiple auditing, and if auditing by all staff passes, the social insurance can be issued. The method can improve the service quality and working efficiency of social insurance processing and can effectively restrain the loss of the social insurance fund.

Owner:智慧眼科技股份有限公司

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com