Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

2670 results about "Transaction processing" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Transaction processing is information processing in computer science that is divided into individual, indivisible operations called transactions. Each transaction must succeed or fail as a complete unit; it can never be only partially complete.

Method and apparatus for automatic placement of advertising

InactiveUS7039599B2Efficient use ofPrevention of ad “burn out.AdvertisementsCash registersWeb siteComputerized system

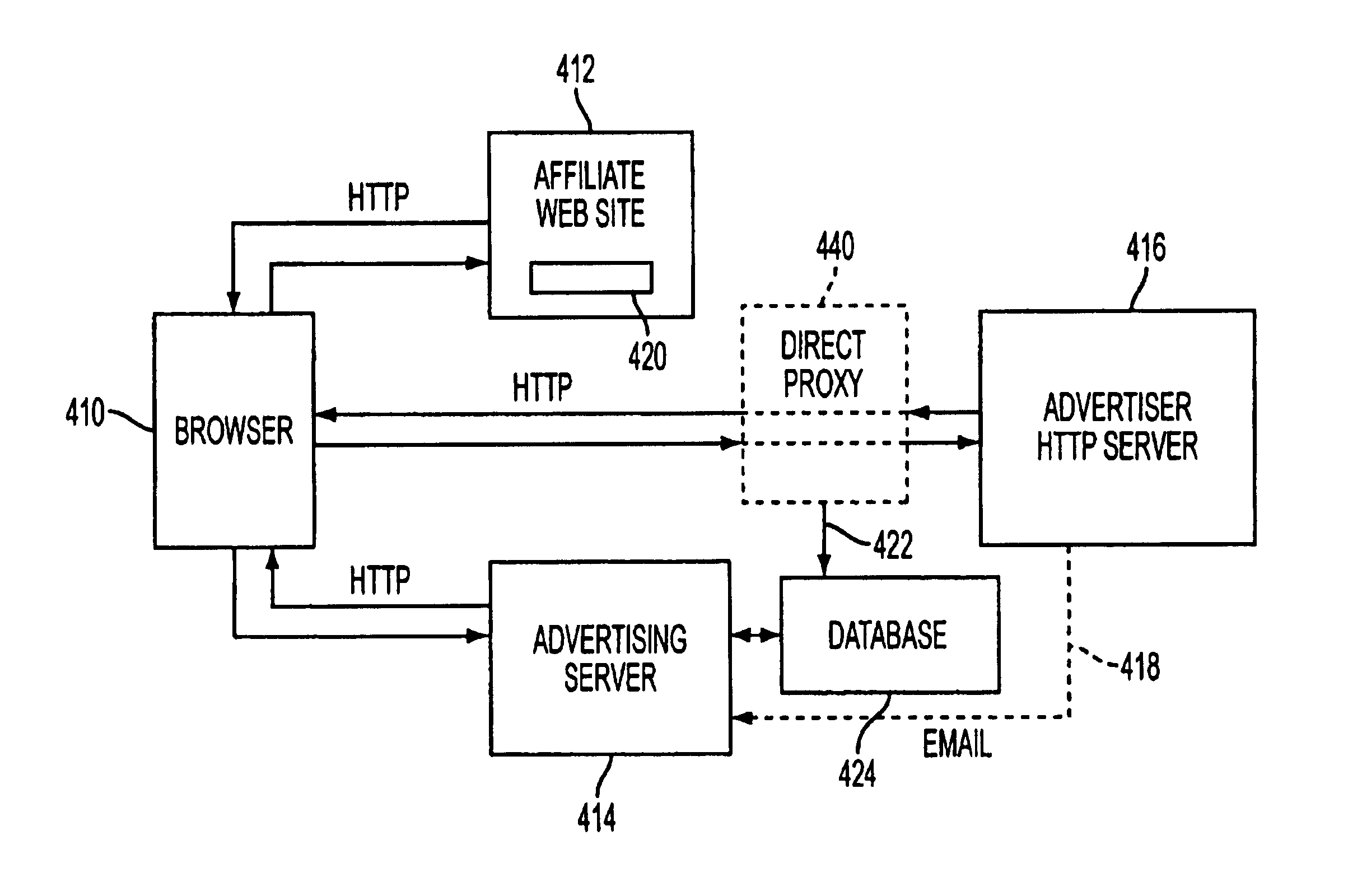

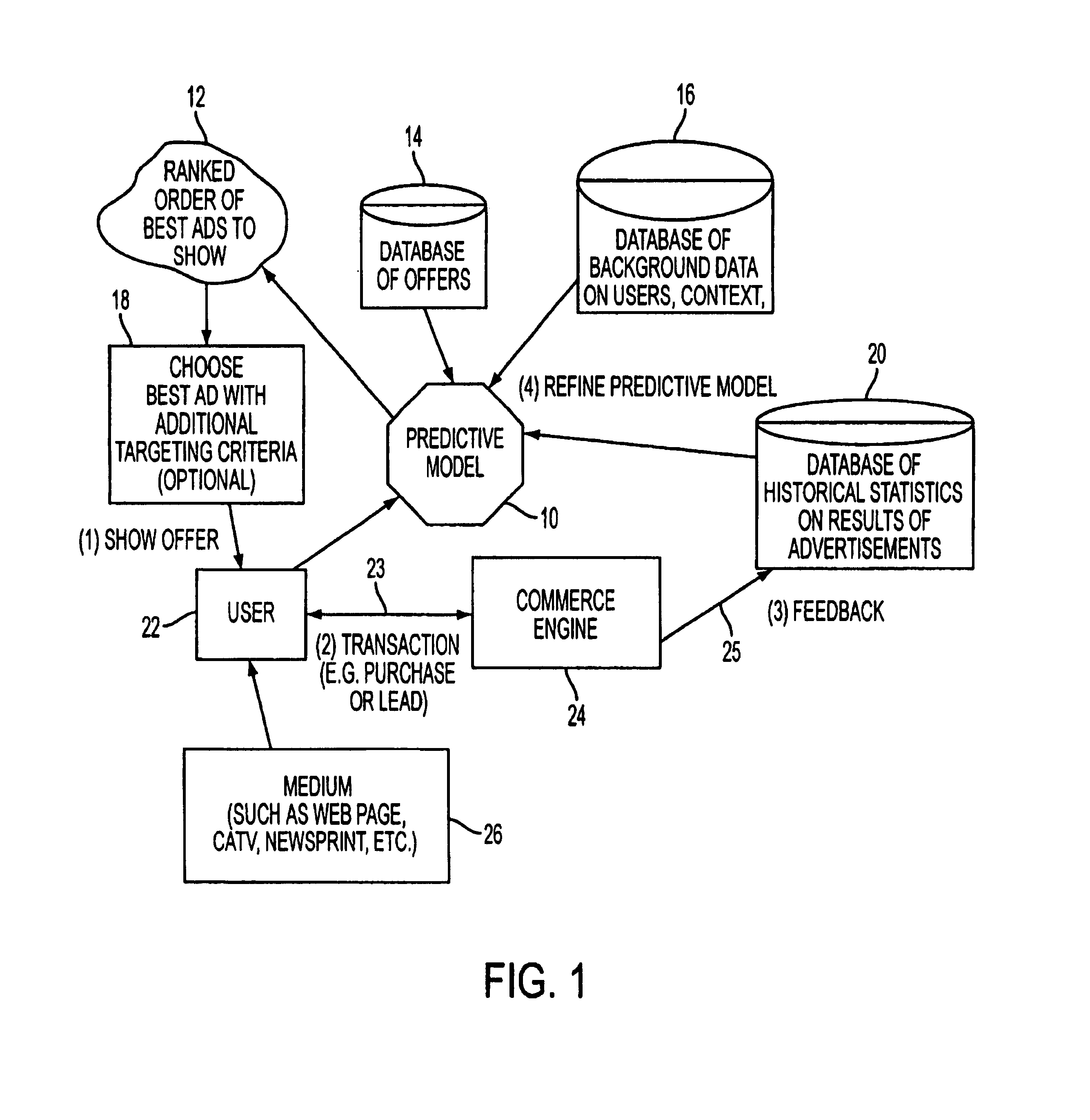

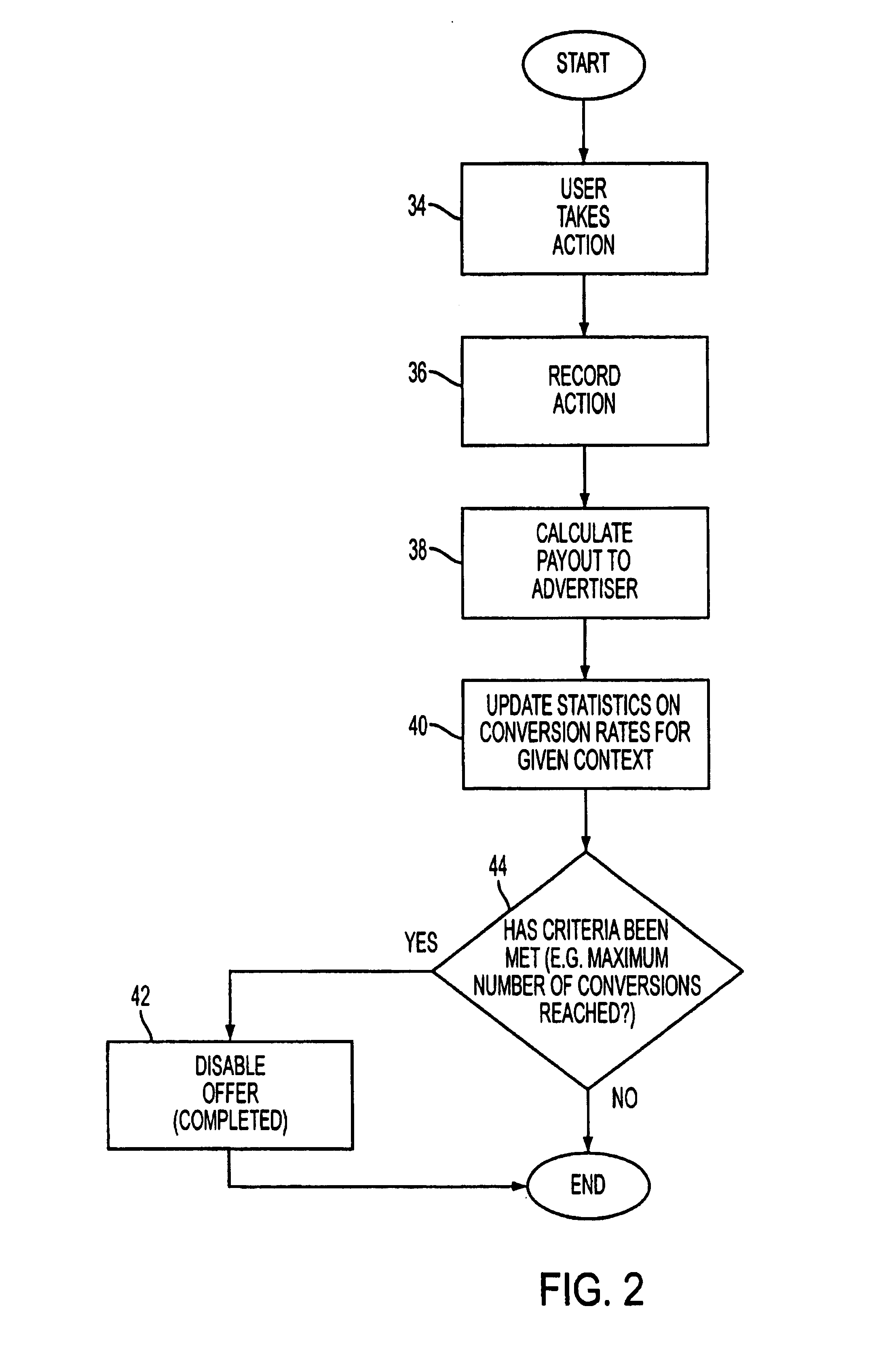

A computer system for automatic replacement of direct advertisements in scarce media includes an advertising server for selecting a direct advertisement based on certain criteria. Transaction results of the direct advertisement placement are reported back to the advertising server, and an associated accounting system. In one embodiment, the direct advertiser's server reports transactions back to the advertising server by email. In a second embodiment, a direct proxy server brokers the user's session (or interaction) with the direct advertiser's server, including transaction processing and the direct proxy server reports the results of transactions back to the advertising server and its associated accounting system. A direct proxy provides an independent audit of transactions at a remote direct advertiser's web site. The feedback of the results of direct advertisement transactions provides an efficient utilization of direct advertising space by way of an automated computer system with a predictive model for selection and distribution of direct advertising.

Owner:GOOGLE LLC

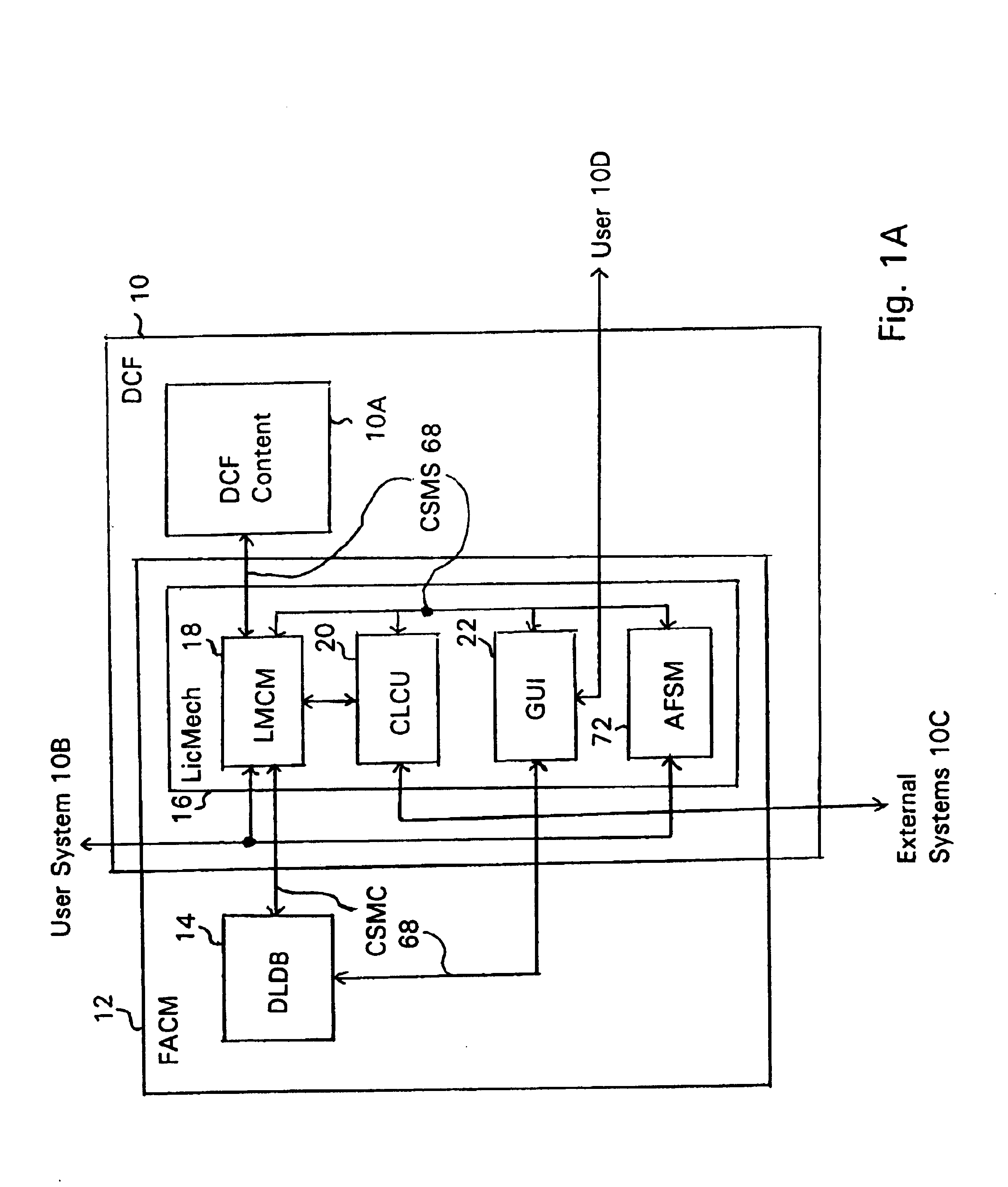

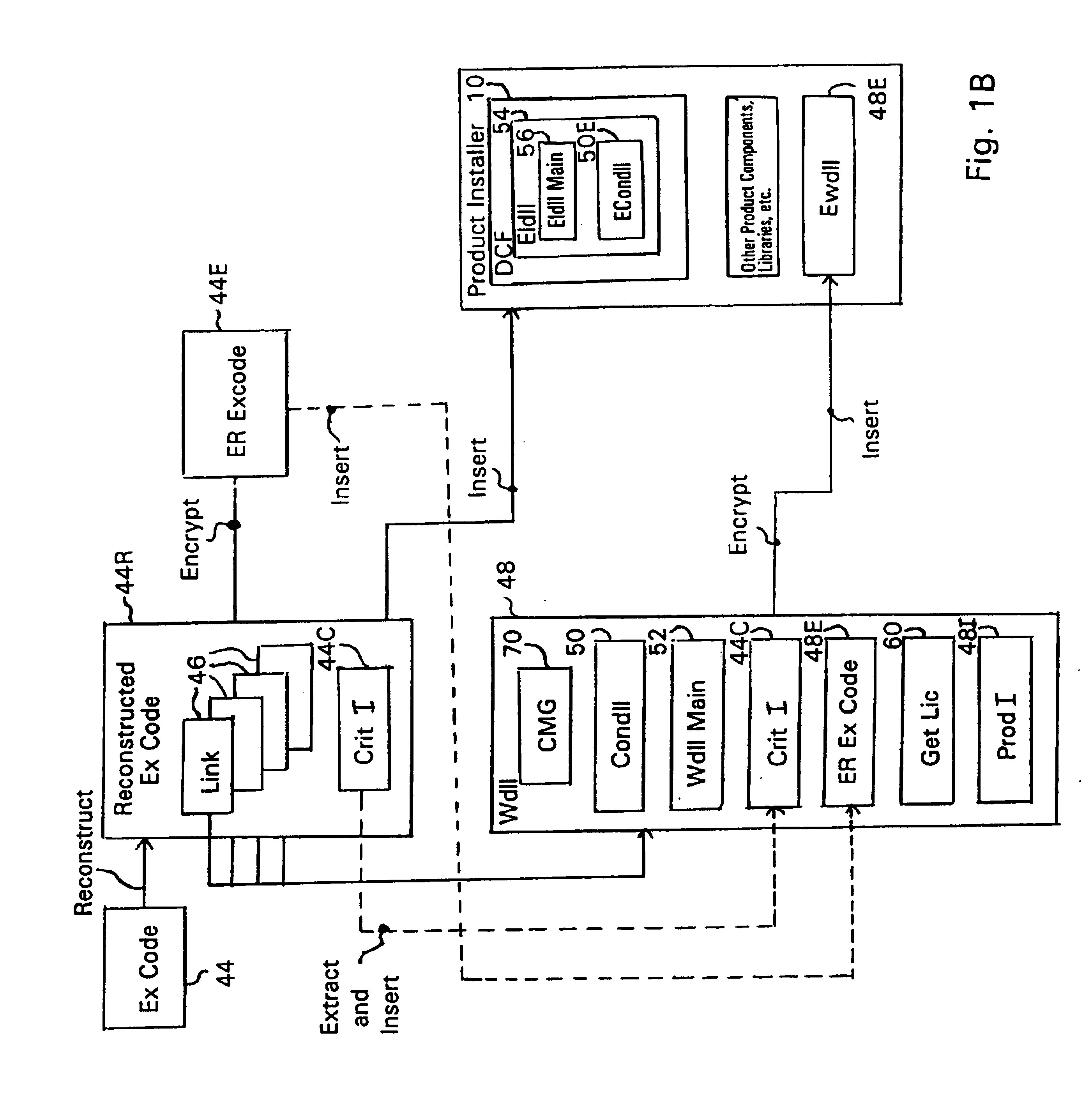

System and embedded license control mechanism for the creation and distribution of digital content files and enforcement of licensed use of the digital content files

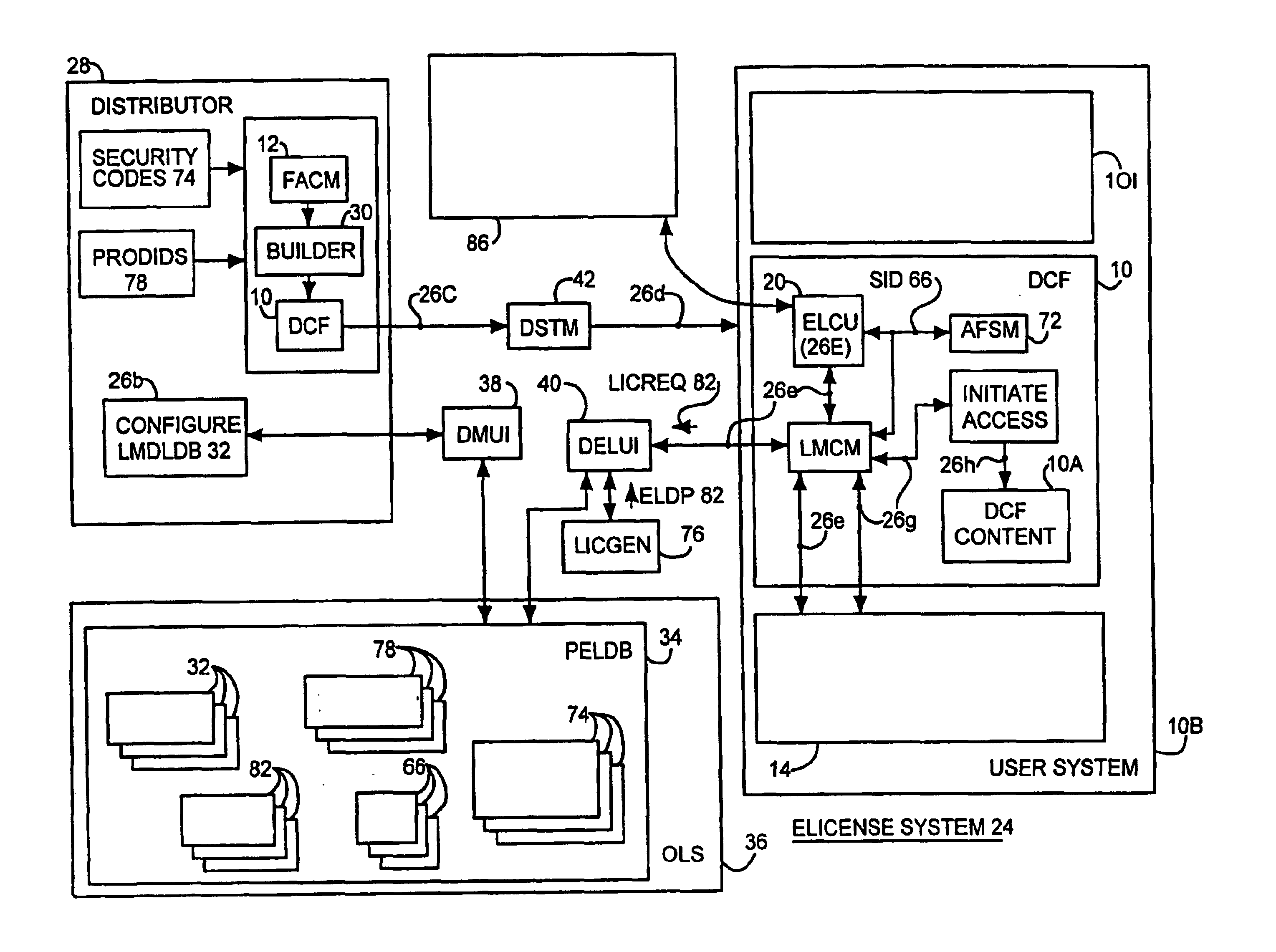

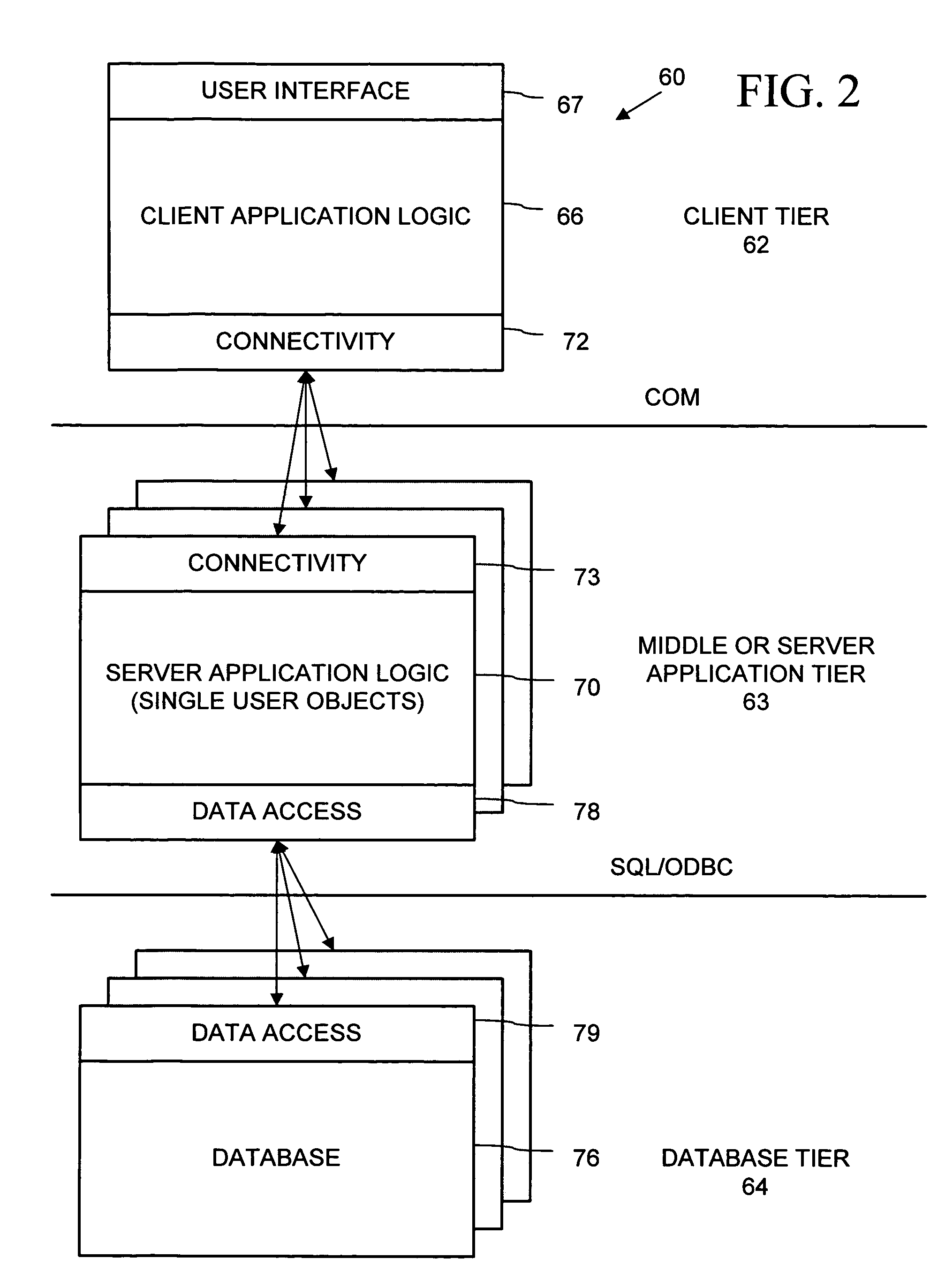

A digital content file including a license control mechanism controlling the licensed use of digital content and a system and method for distributing licensable digital content files and licenses. A digital content file includes a digital content, which may be executable code or data, an embedded file access control mechanism and a dynamic license database associated with the file access mechanism for storing license information used by the file access control mechanism in controlling use of the digital content. The file access control mechanism includes a license monitor and control mechanism communicating with the dynamic license database and controlling use of the digital content and a license control utility providing communications between a user system and an external system to communicate license definition information and includes a graphical user interface. License information may be stored initially in the dynamic license database or provided from an external system. The system allows the distribution of digital content files and the acquisition of licenses with seamless transaction processing through an order processing system generating an order identification and authorization for a license and a product configuration and order database containing license management databases associated with the digital content files and containing license information to be transmitted to a user system upon receipt of an order identifier. The product configuration and order database also generates a license record for each transaction.

Owner:VIATECH TECH

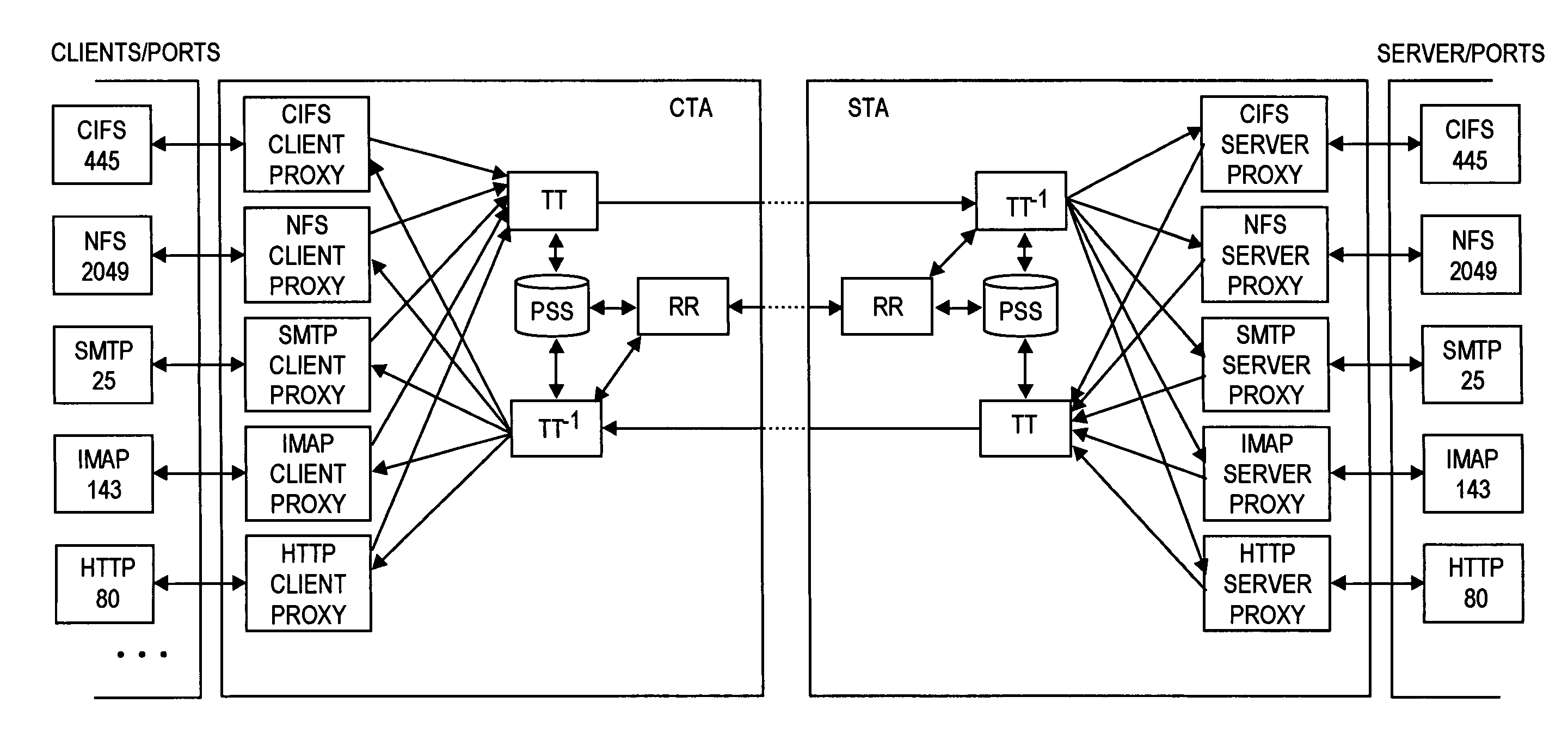

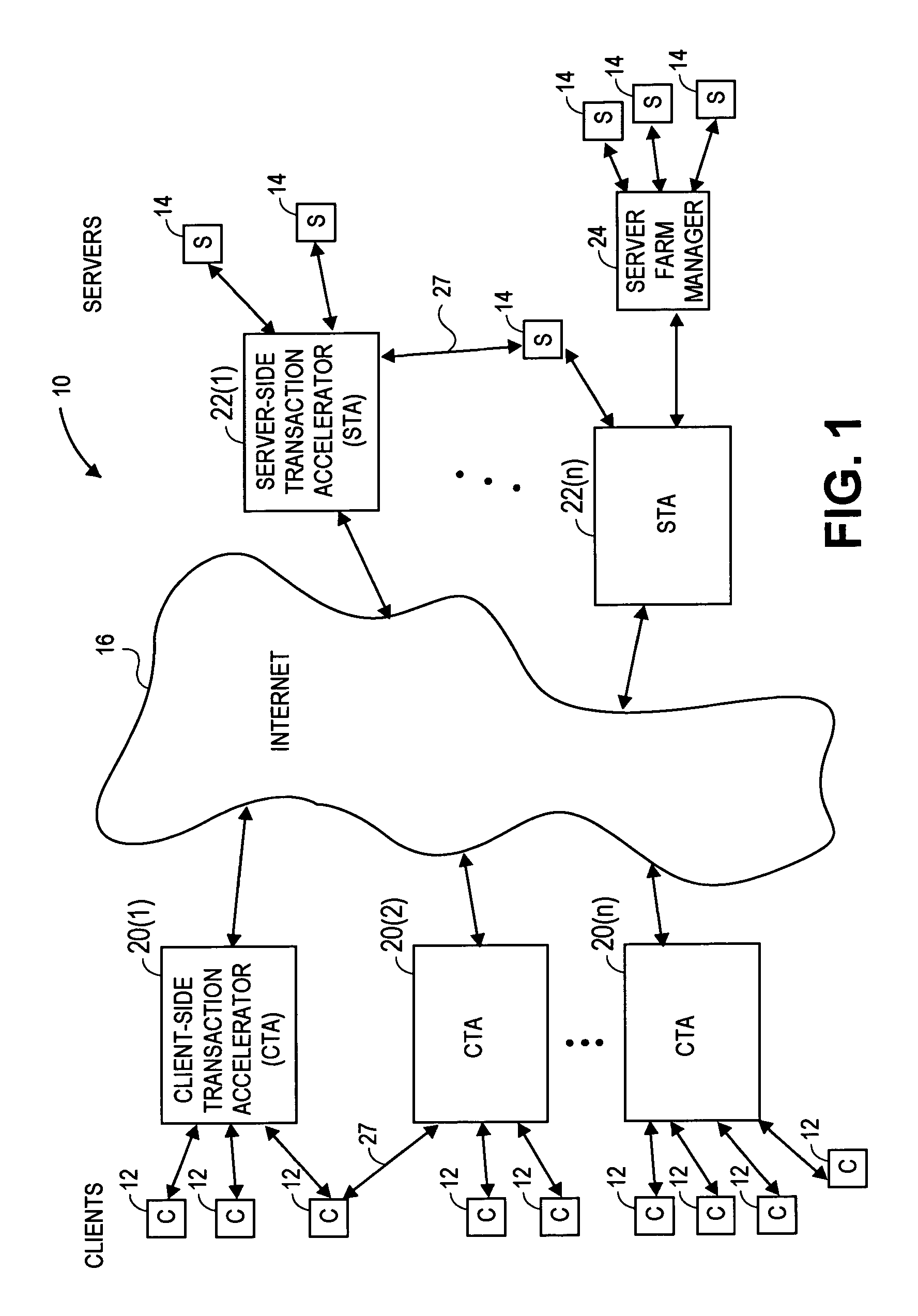

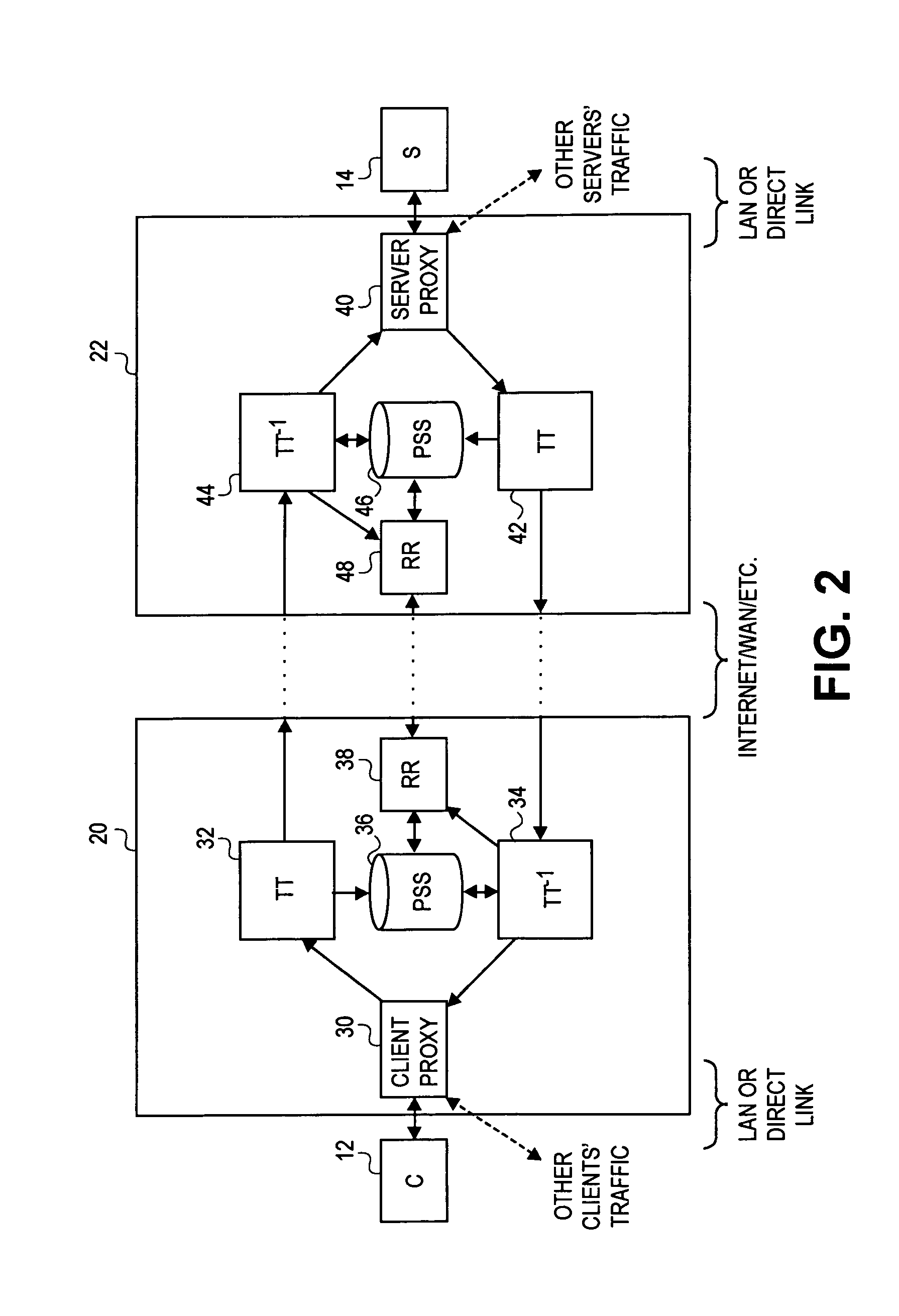

Transaction accelerator for client-server communication systems

InactiveUS7120666B2Reduce network bandwidth usageAccelerating transactionIndividual digits conversionMultiple digital computer combinationsCommunications systemClient-side

In a network having transaction acceleration, for an accelerated transaction, a client directs a request to a client-side transaction handler that forwards the request to a server-side transaction handler, which in turn provides the request, or a representation thereof, to a server for responding to the request. The server sends the response to the server-side transaction handler, which forwards the response to the client-side transaction handler, which in turn provides the response to the client. Transactions are accelerated by the transaction handlers by storing segments of data used in the transactions in persistent segment storage accessible to the server-side transaction handler and in persistent segment storage accessible to the client-side transaction handler. When data is to be sent between the transaction handlers, the sending transaction handler compares the segments of the data to be sent with segments stored in its persistent segment storage and replaces segments of data with references to entries in its persistent segment storage that match or closely match the segments of data to be replaced. The receiving transaction store reconstructs the data sent by replacing segment references with corresponding segment data from its persistent segment storage, requesting missing segments from the sender as needed. The transaction accelerators could handle multiple clients and / or multiple servers and the segments stored in the persistent segment stores can relate to different transactions, different clients and / or different servers. Persistent segment stores can be prepopulated with segment data from other transaction accelerators.

Owner:RIVERBED TECH LLC

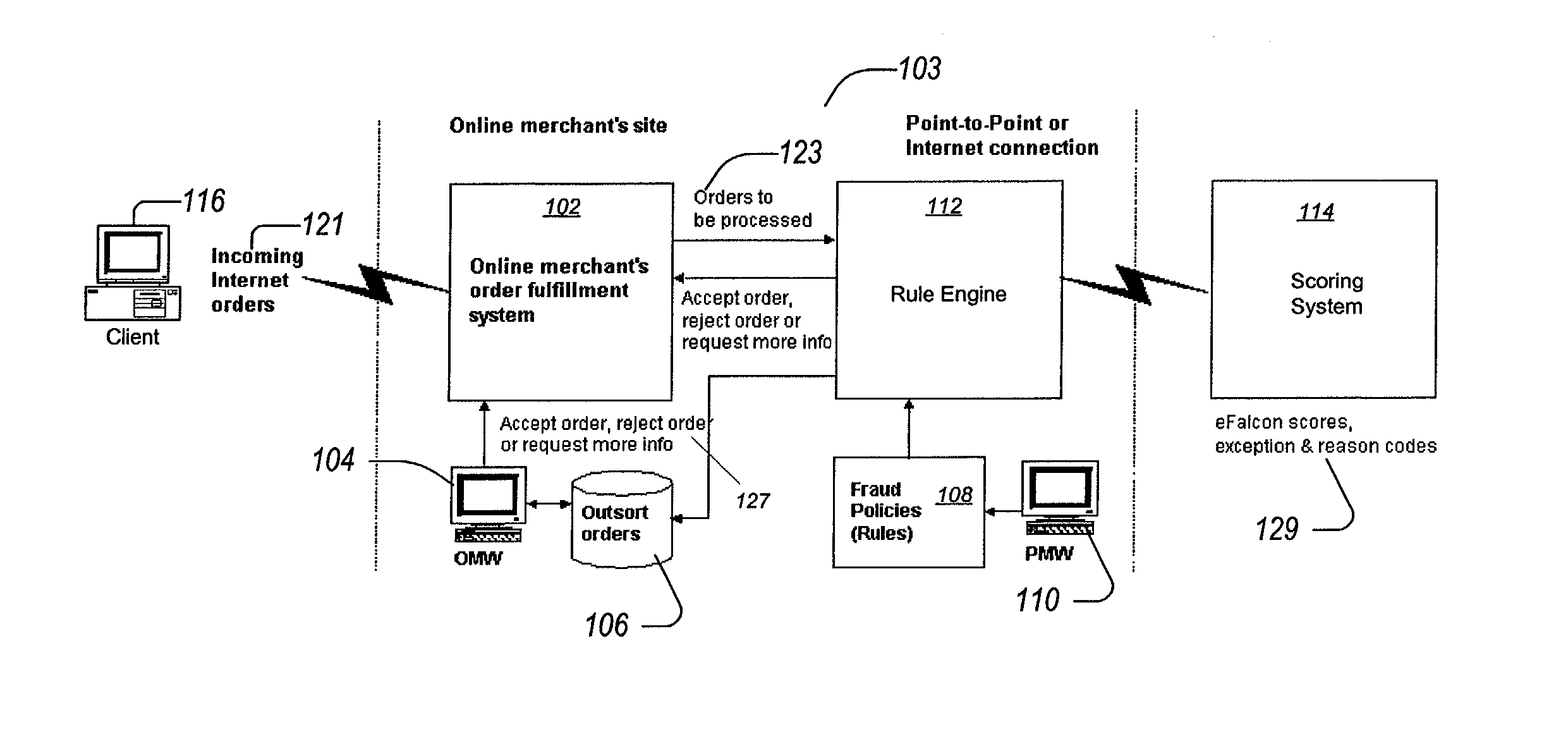

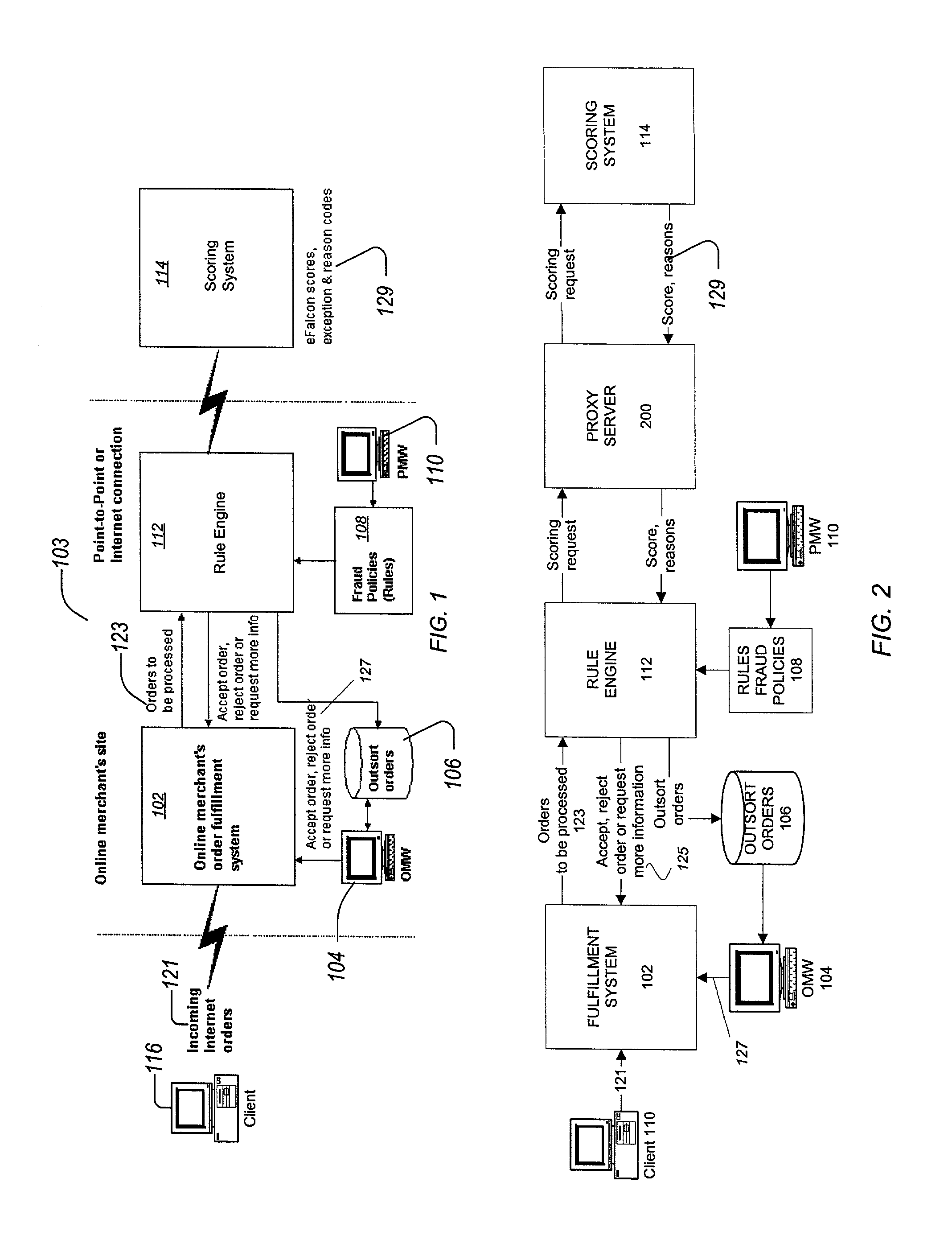

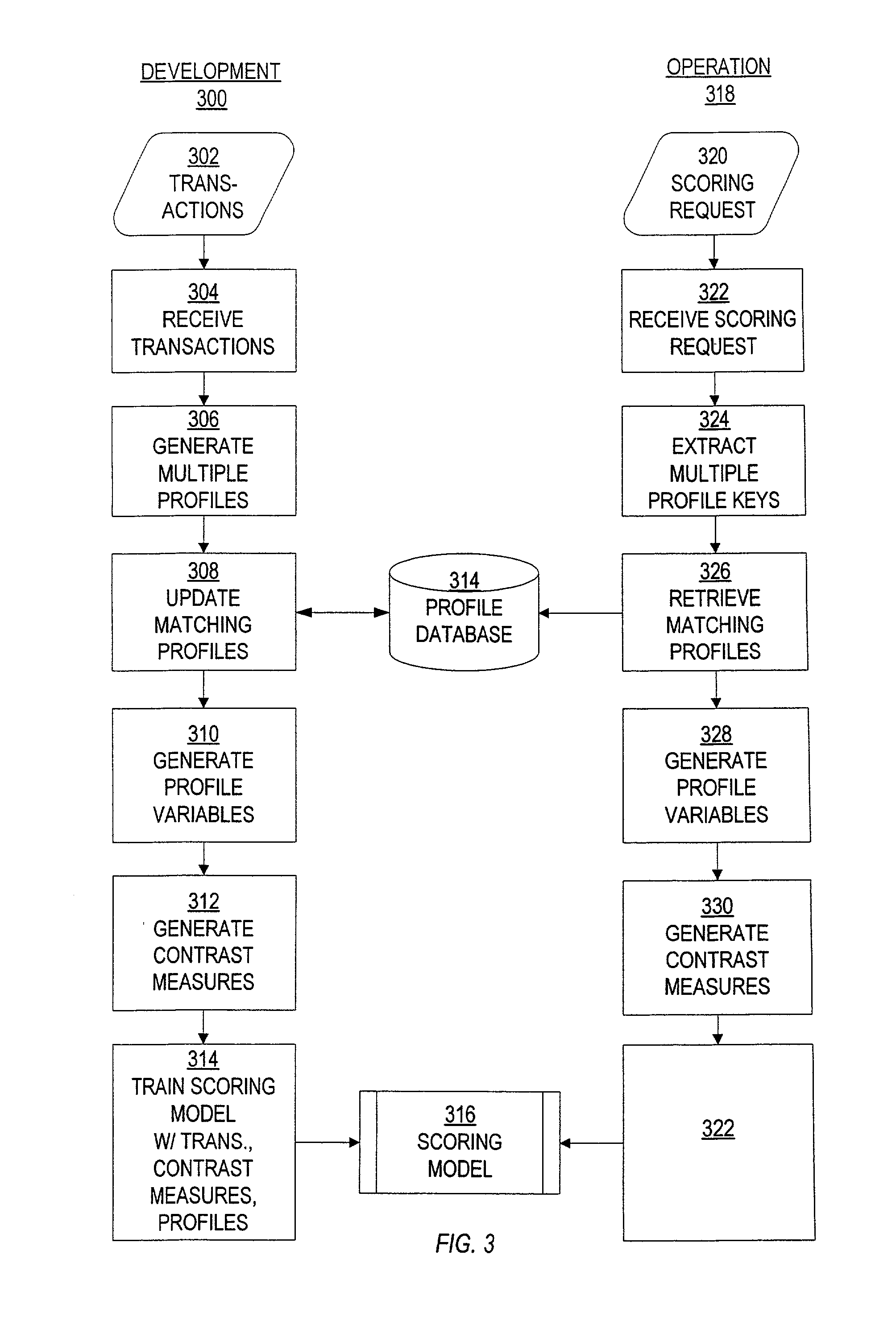

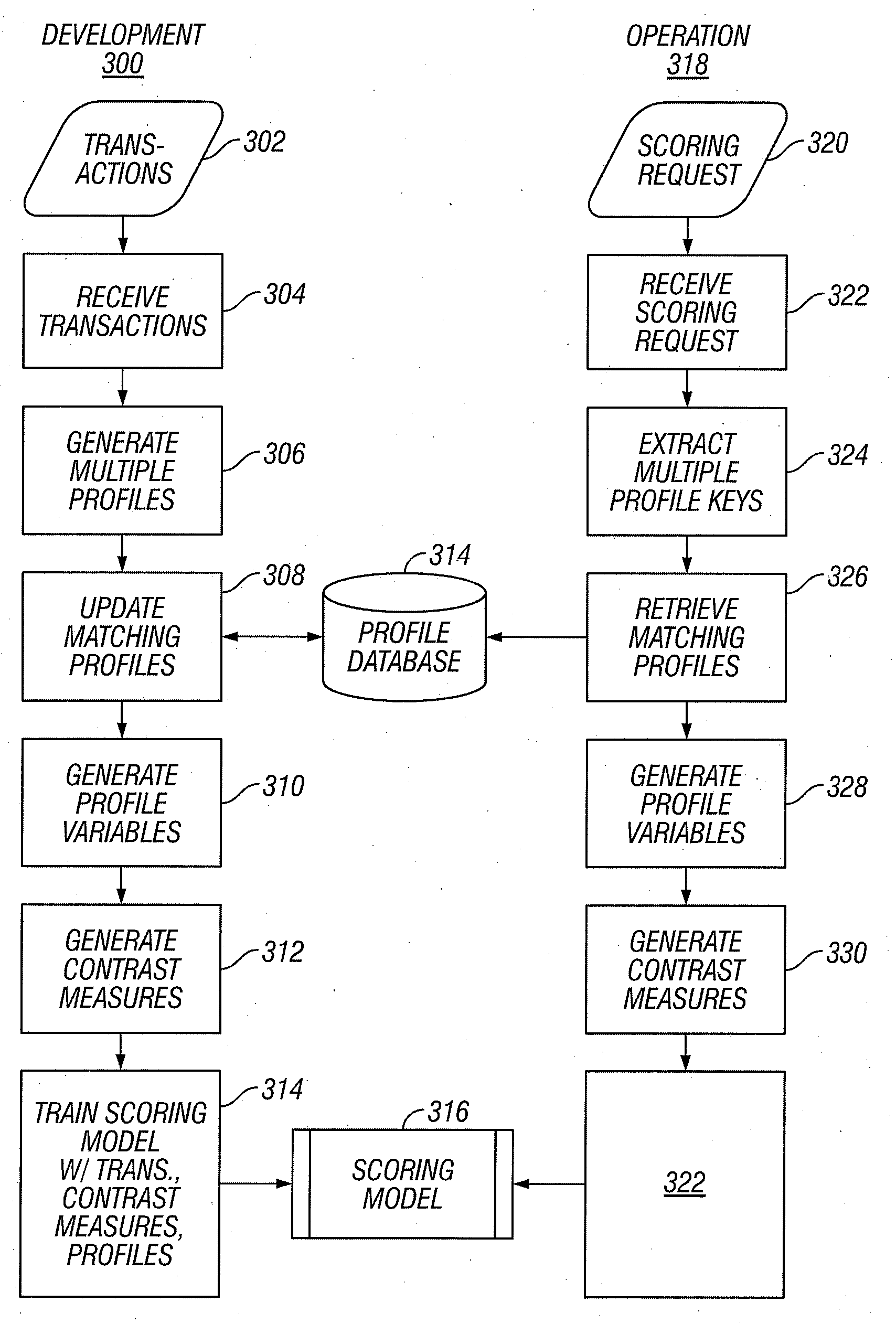

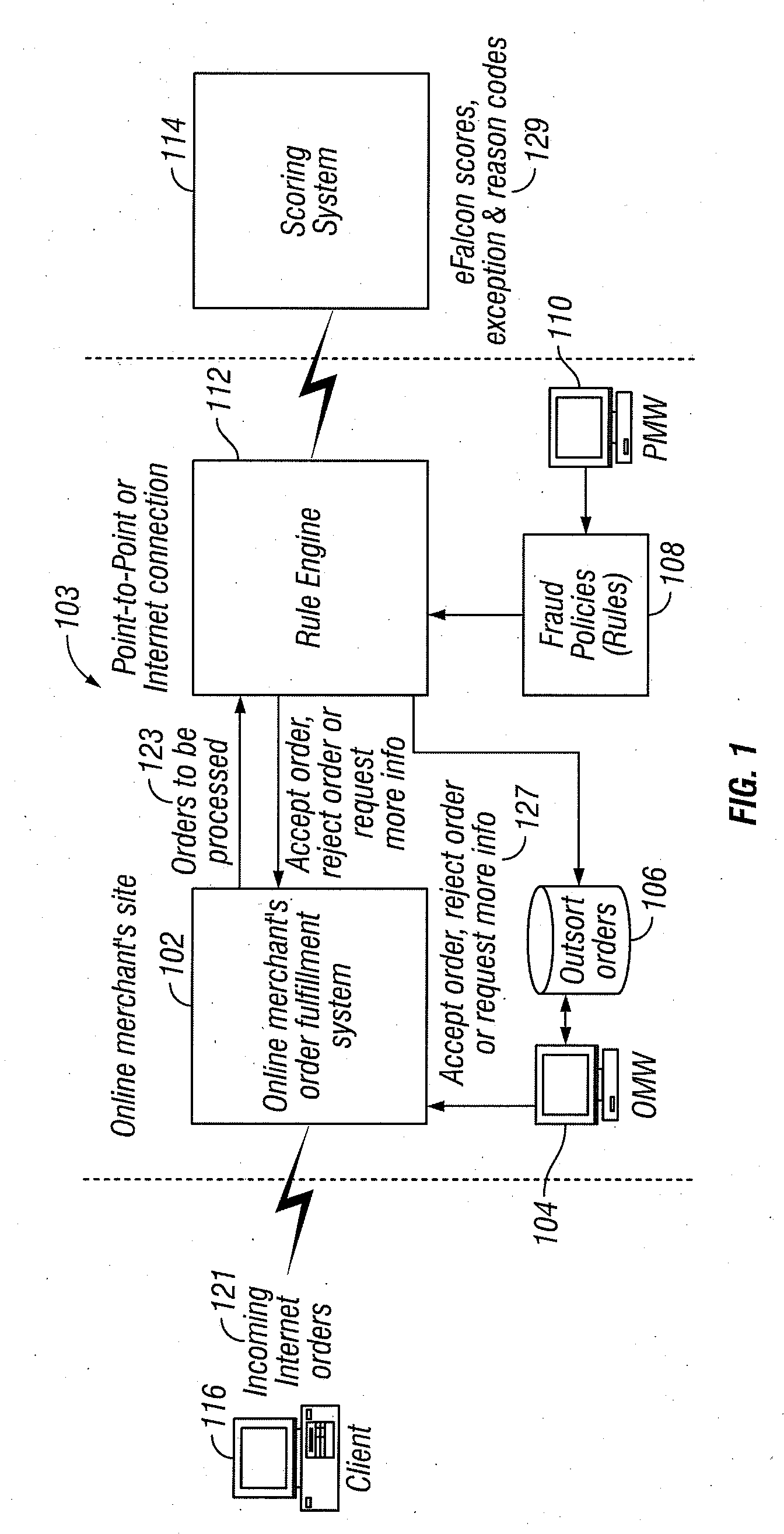

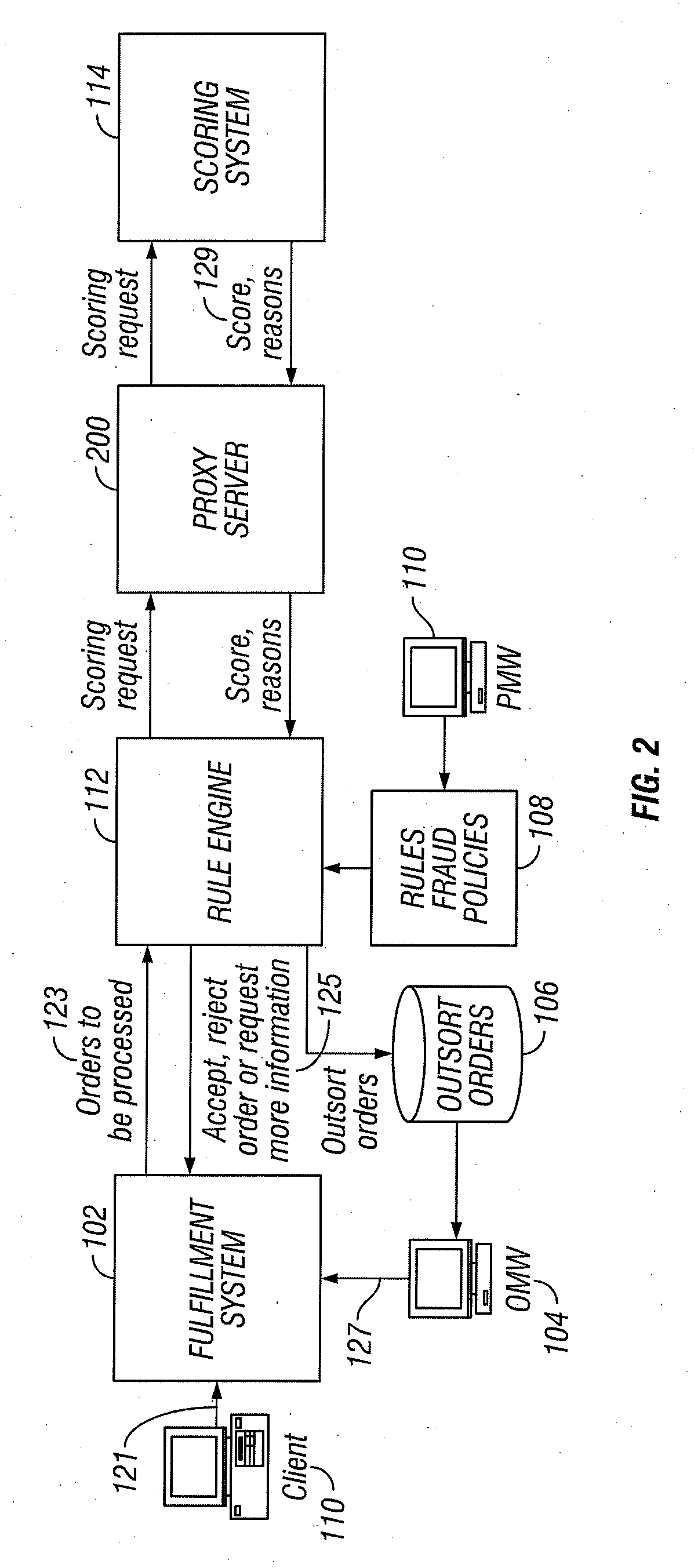

Identification and management of fraudulent credit/debit card purchases at merchant ecommerce sites

ActiveUS7263506B2Reduce exposureFinanceBuying/selling/leasing transactionsE-commerceFinancial transaction

Transaction processing of online transactions at merchant sites determines the likelihood that such transactions are fraudulent, accounting for unreliable fields of a transaction order, which fields do not reliably identify a purchaser. A scoring server using statistical model uses multiple profiles associated with key fields, along with weights to indicate the degree to which the profiles identify the purchaser of the transaction.

Owner:FAIR ISAAC & CO INC

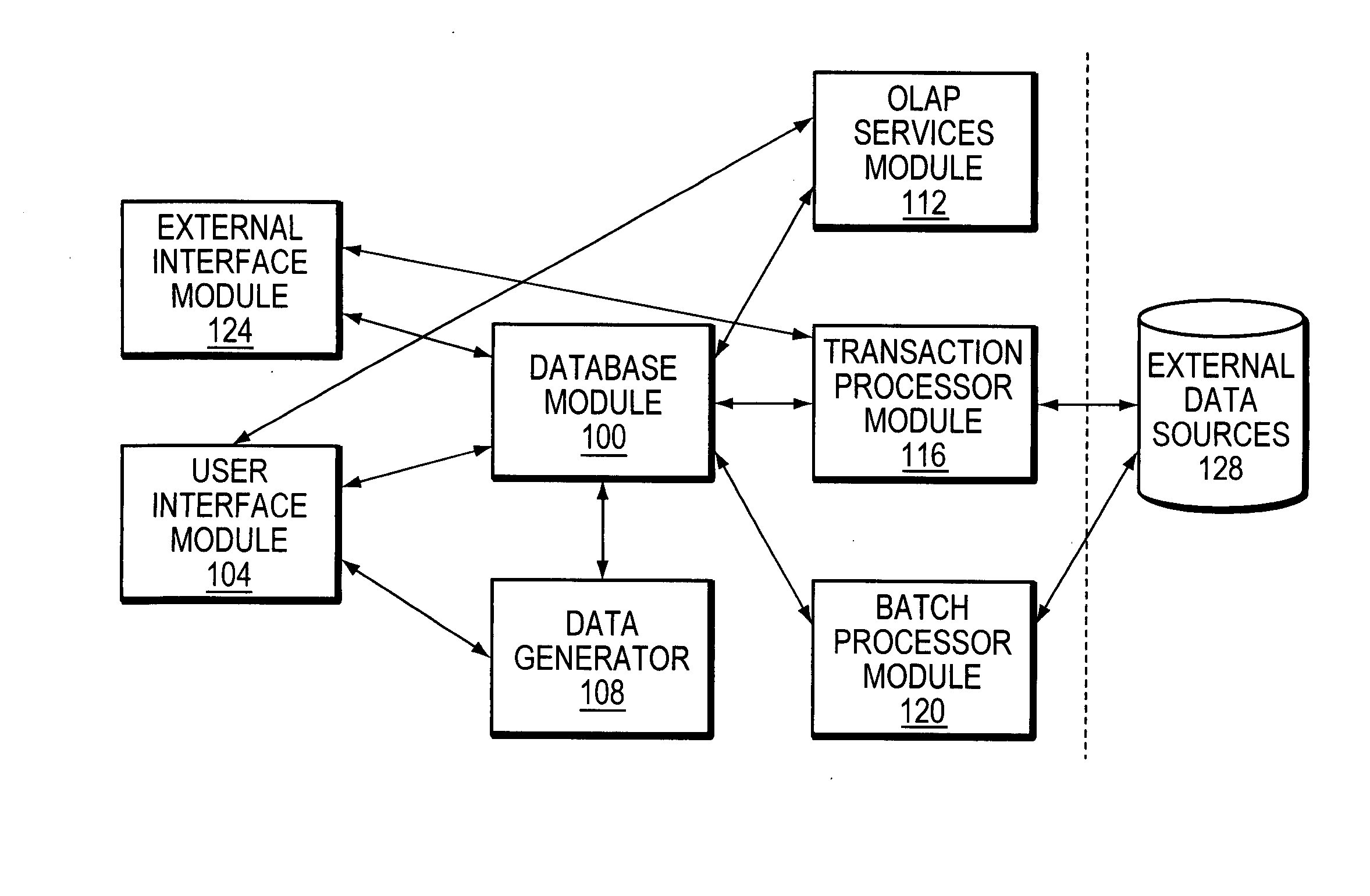

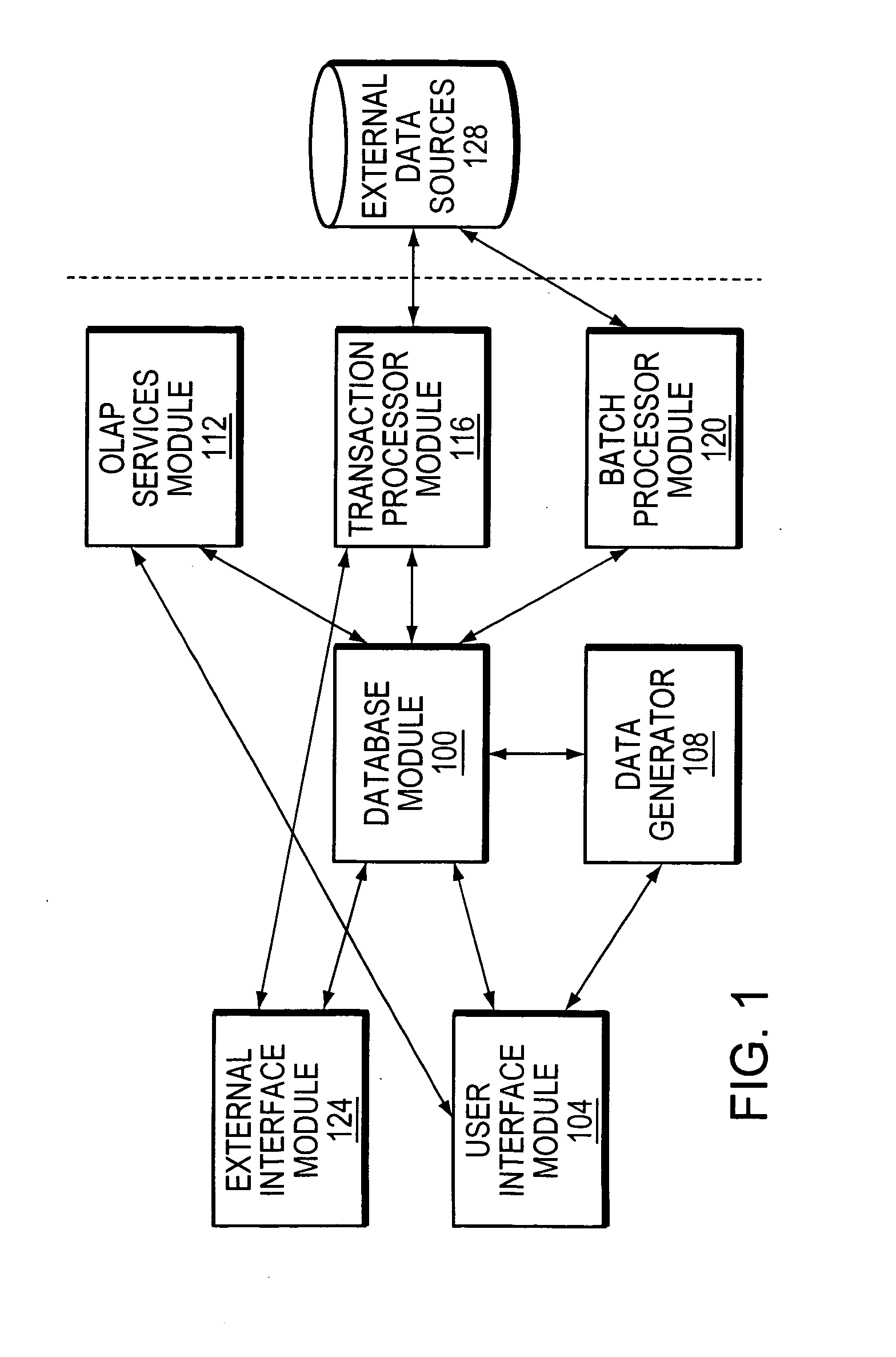

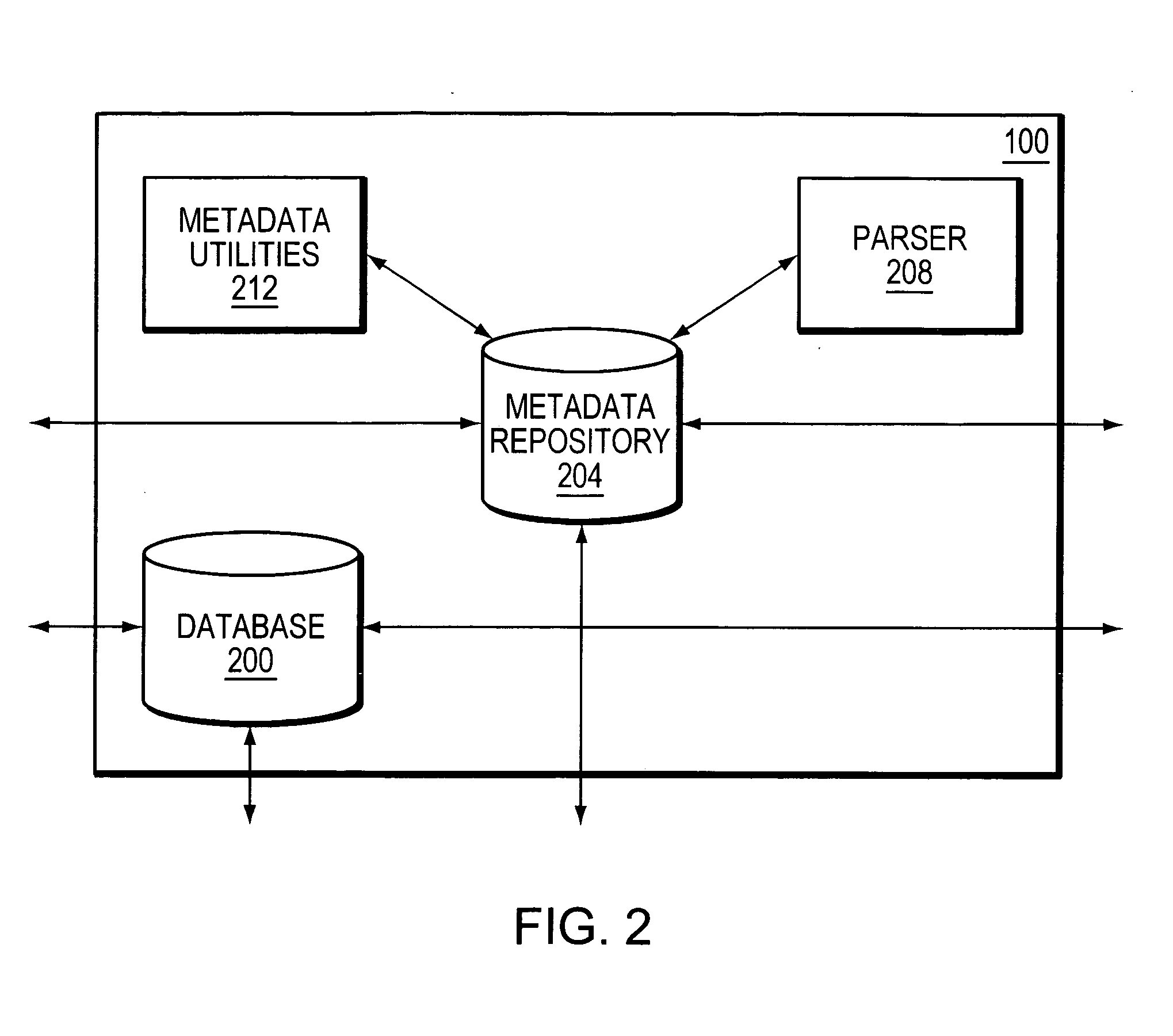

Database system and methods

ActiveUS7249118B2Avoid inefficiencyData processing applicationsDigital data information retrievalDatabaseMetadata

In general, in one aspect, the invention relates to a method for transaction processing. The method includes specifying metadata and storing the metadata. An index is created in response to the stored metadata. The method also includes receiving a transaction, generating an index log of changes to the index in response to the received transaction, and modifying the first index in response to the generated index log.

Owner:SYBASE INC

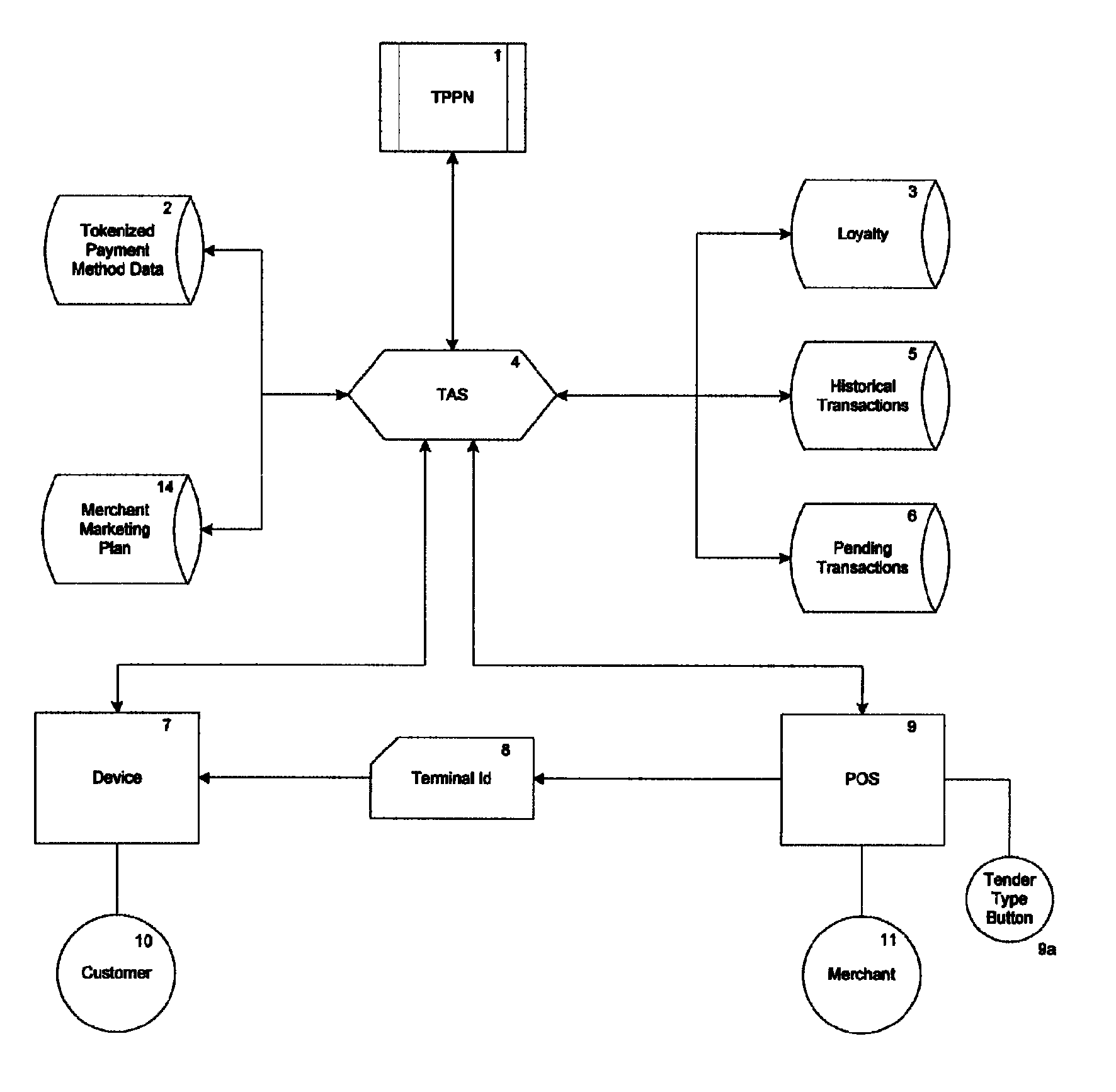

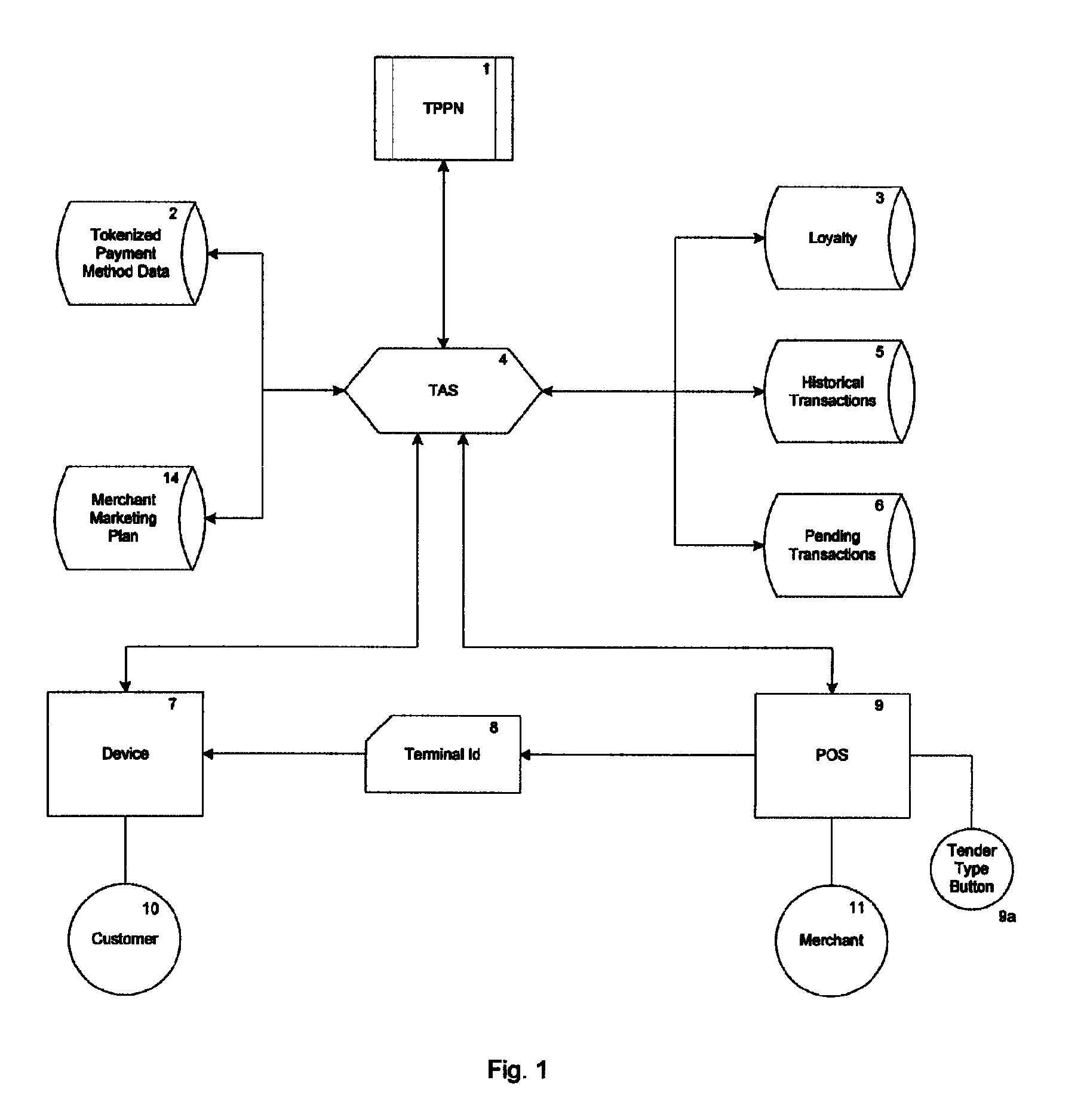

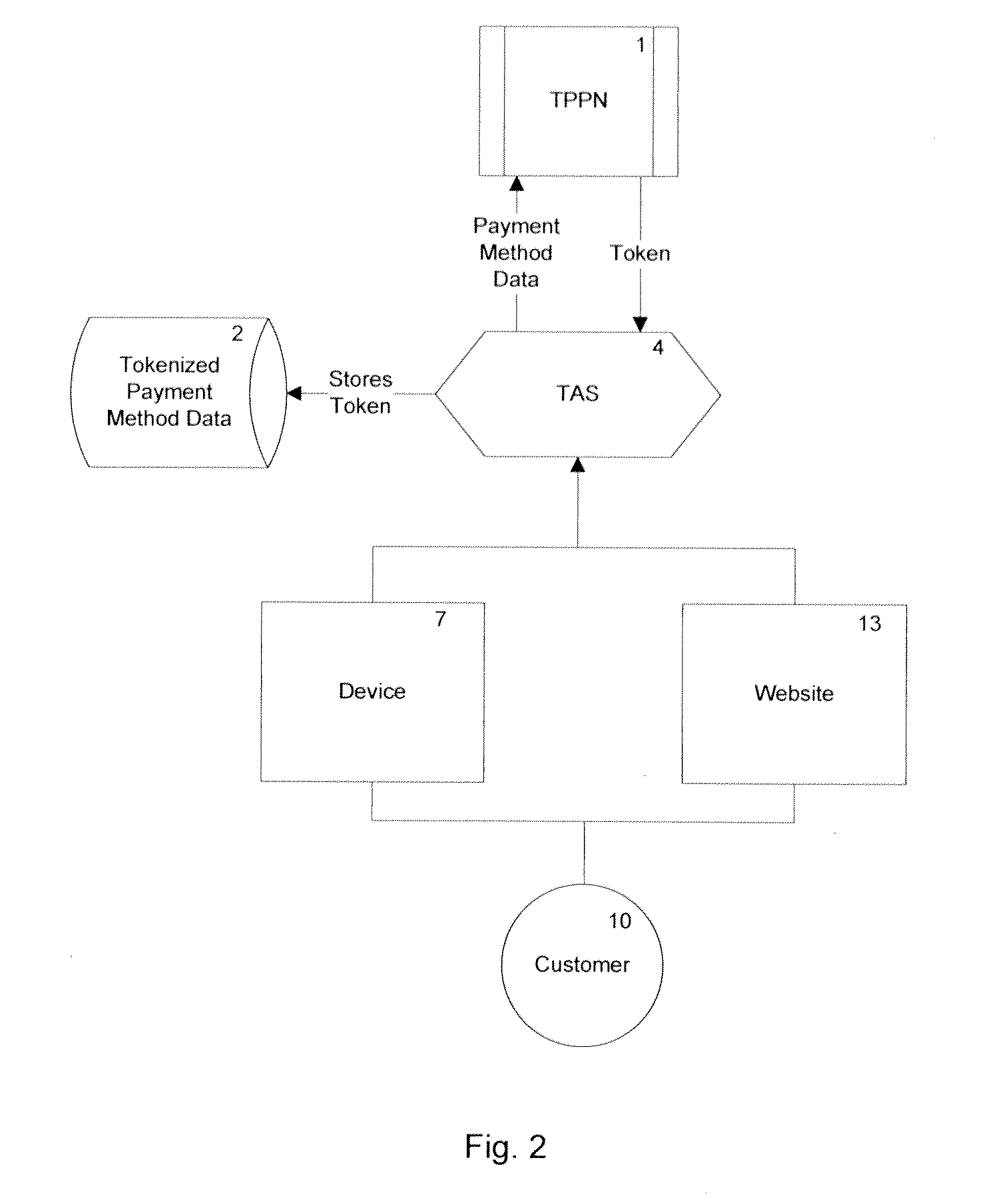

Mobile system and method for payments and non-financial transactions

InactiveUS8635157B2Readily availableLow costFinanceBuying/selling/leasing transactionsVirtual terminalPayment transaction

A method and system for mobile commerce, communication, and transaction processing to real-world POS, web, e-commerce, virtual terminal, mobile personal digital assistant, mobile phone, mobile device, or other computer based transactions involving either one or both financial and non-financial such as loyalty based transactions as a mobile payment system is described. One embodiment comprises using a mobile phone via a consumer mobile software application (CMA) in lieu of a consumer card (examples include physical, virtual, or chips) to conduct payment transactions in the Real or Virtual World of commerce. An embodiment is related to making payments to real-world stores via having the CMA on a mobile device on behalf of the consumer present to conduct transactions and no physical card required.

Owner:PAYME

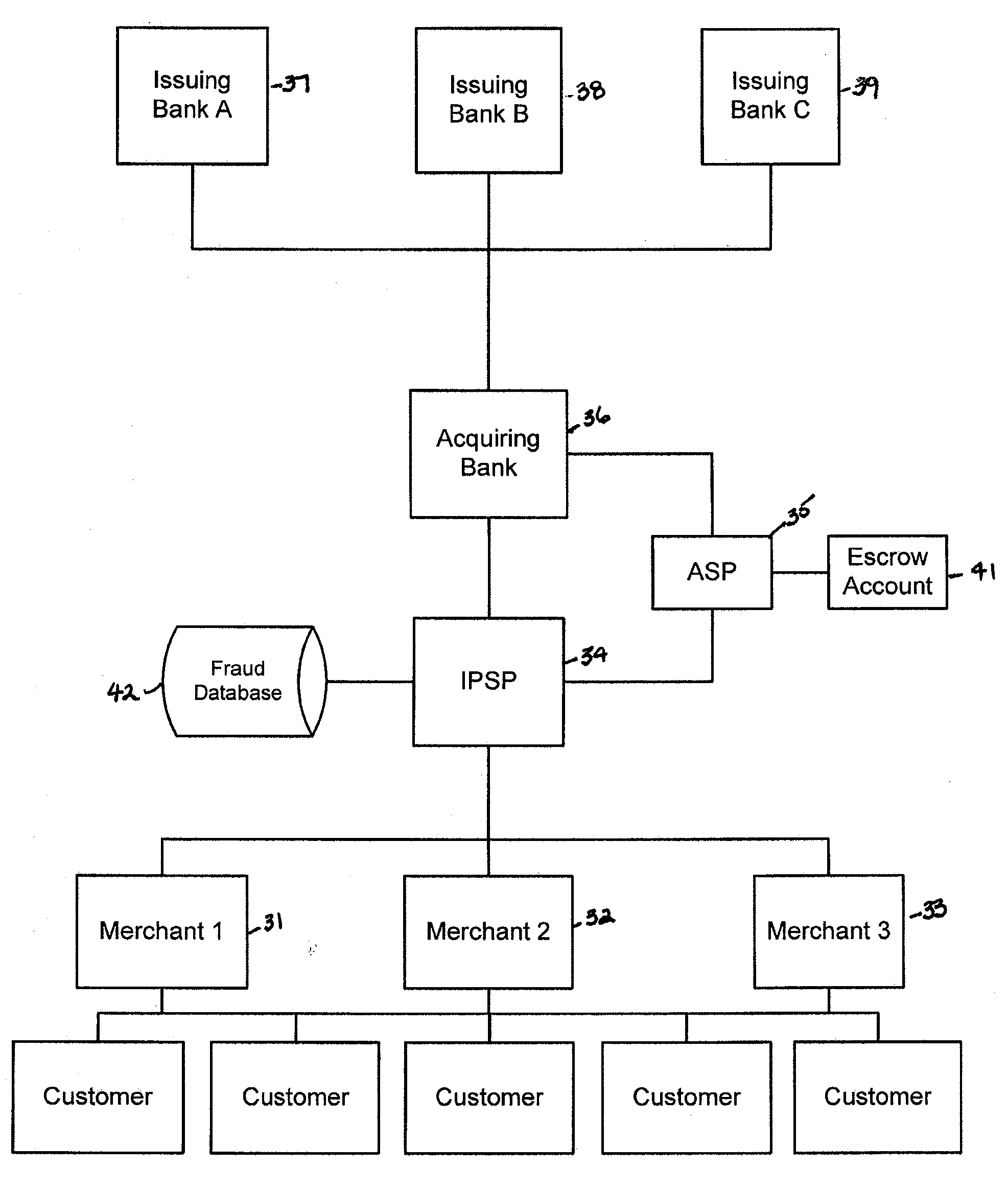

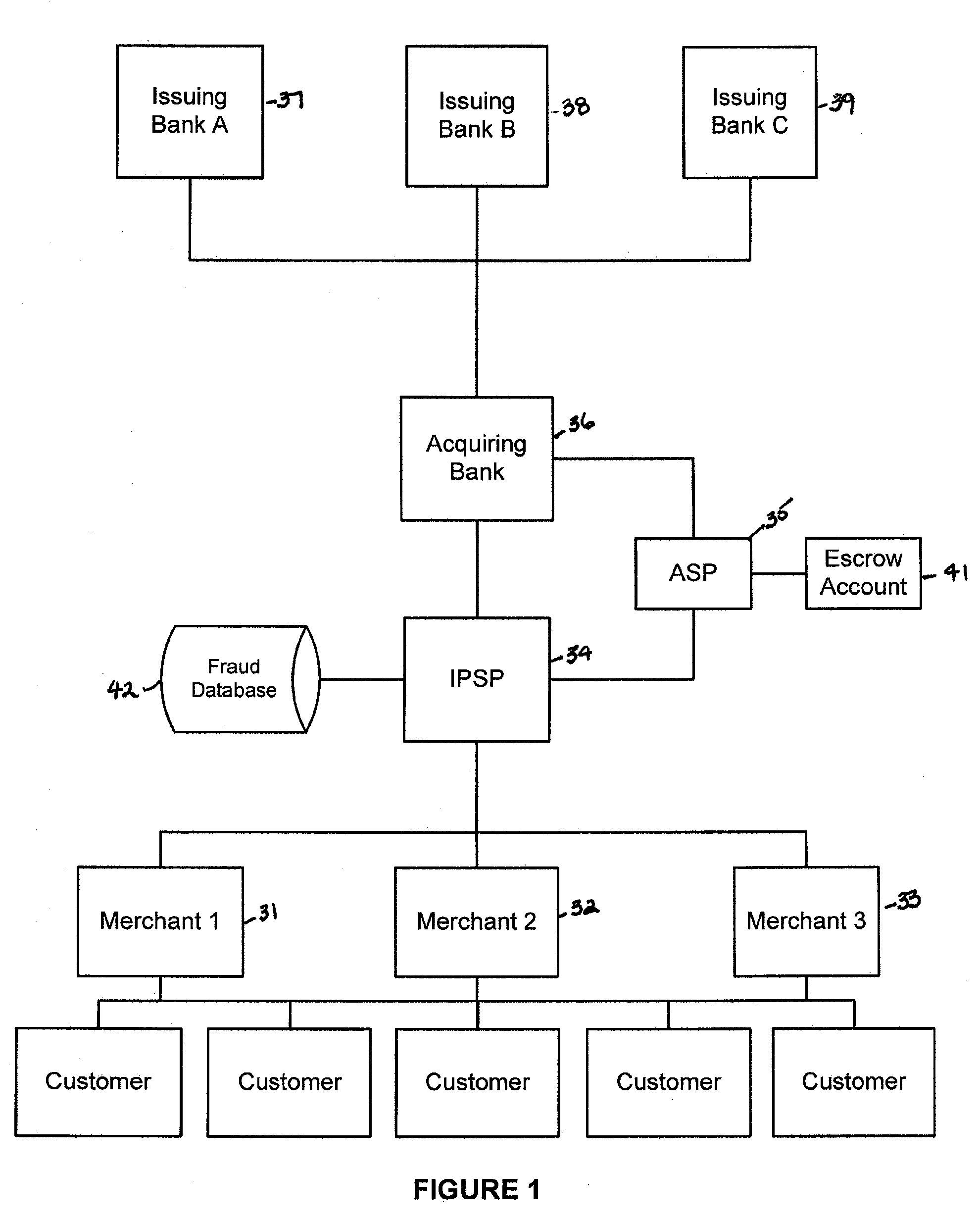

Financial transactions systems and methods

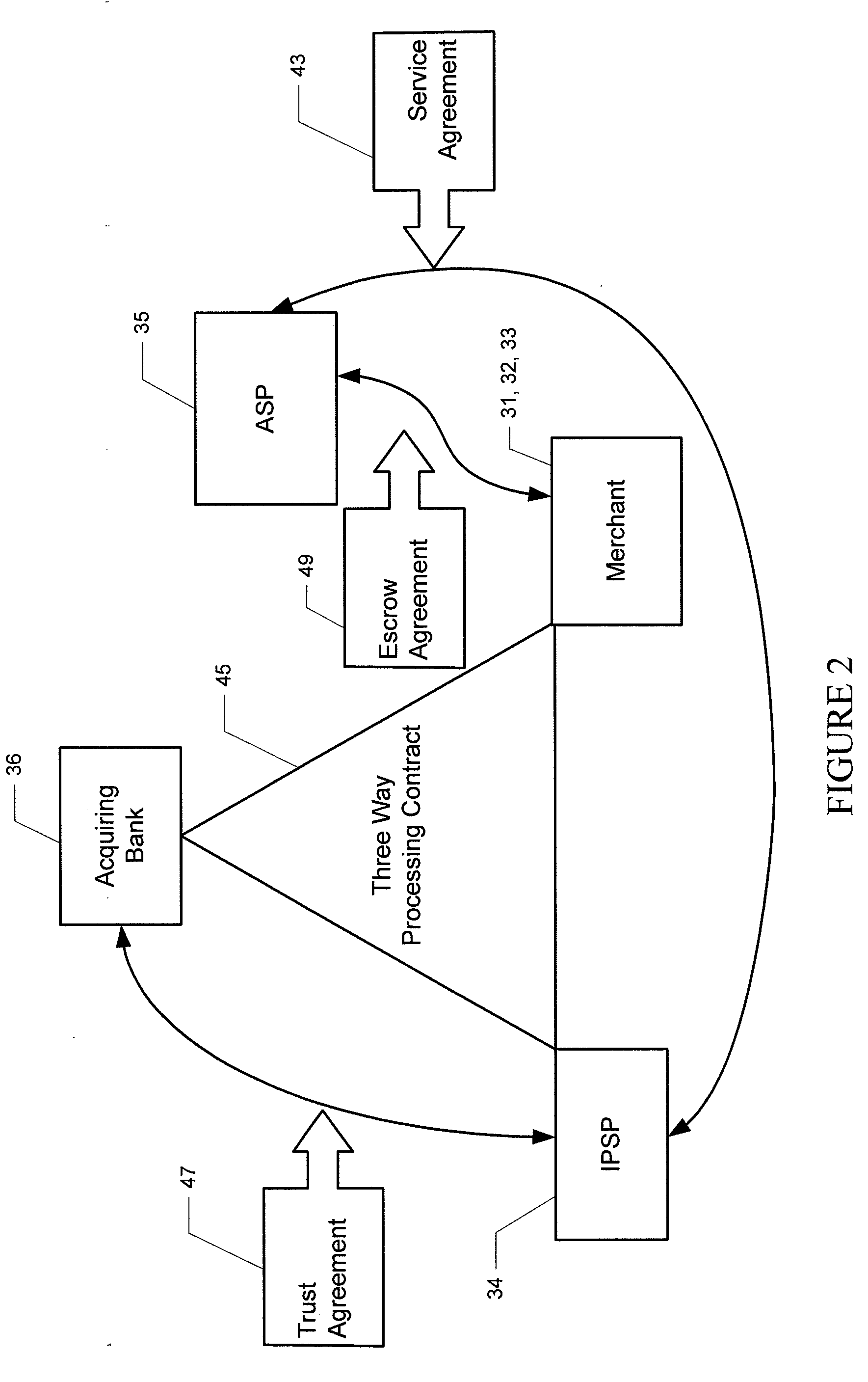

InactiveUS20100106611A1Reduce percentageFinanceApparatus for meter-controlled dispensingPayment transactionService provision

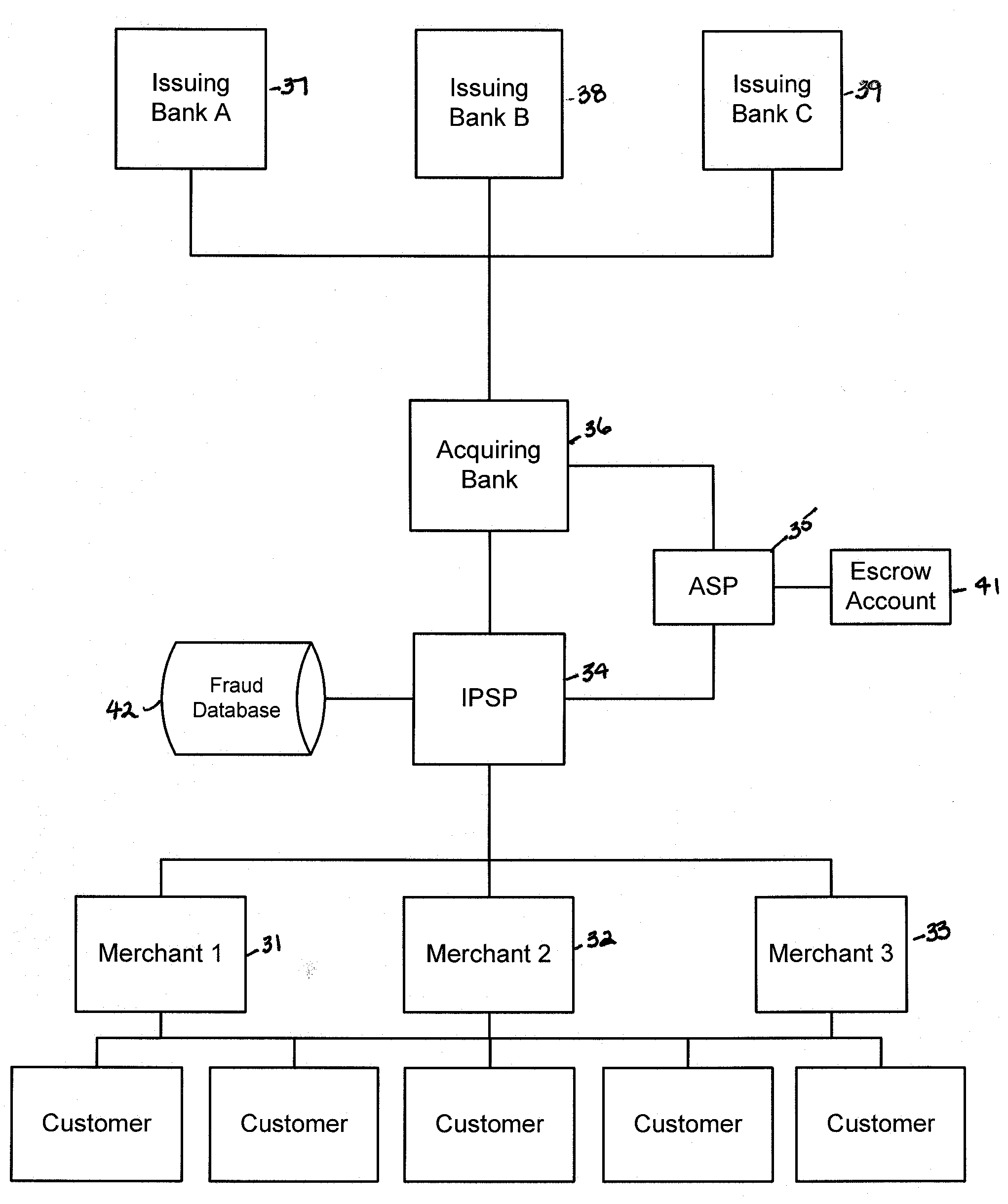

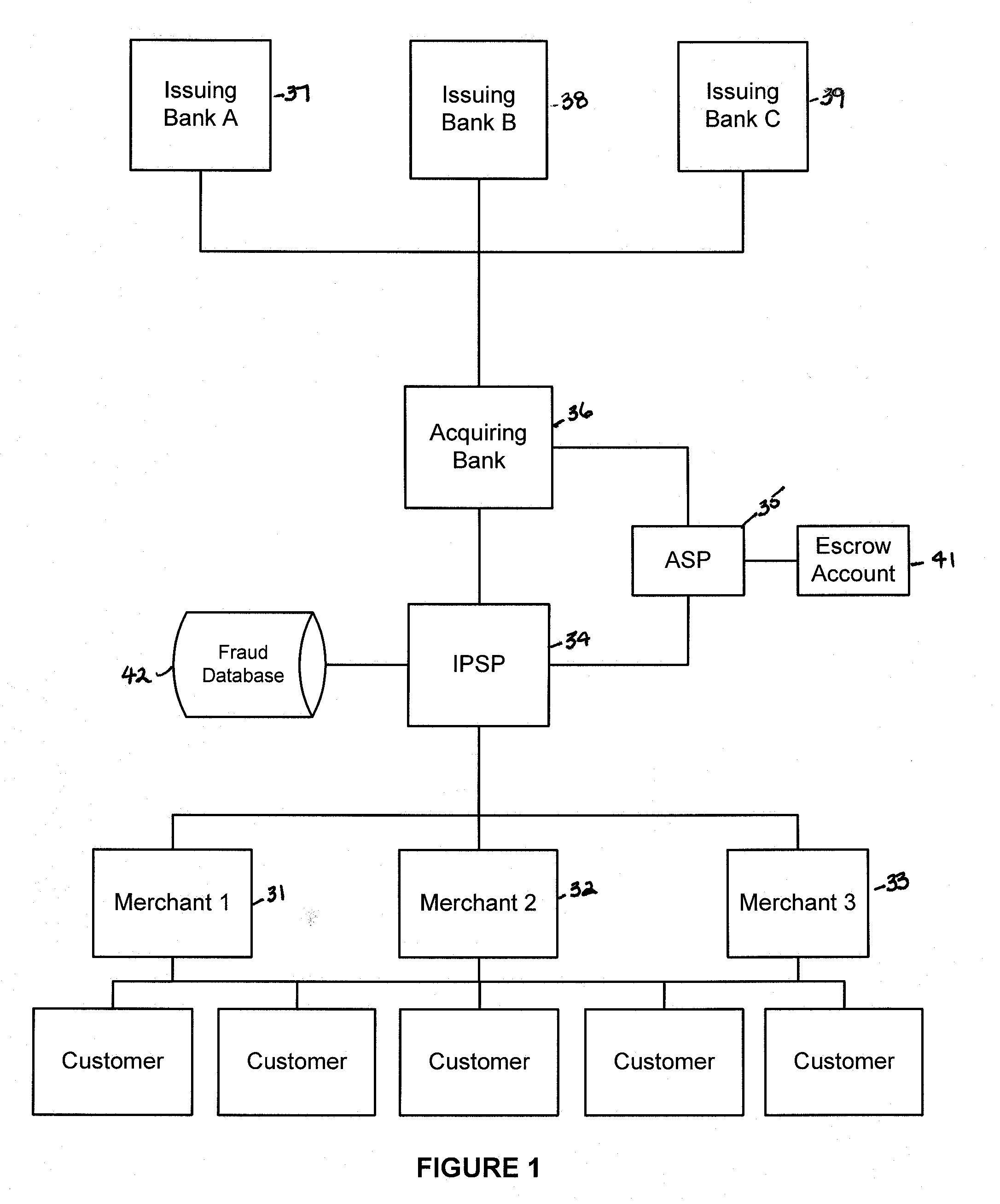

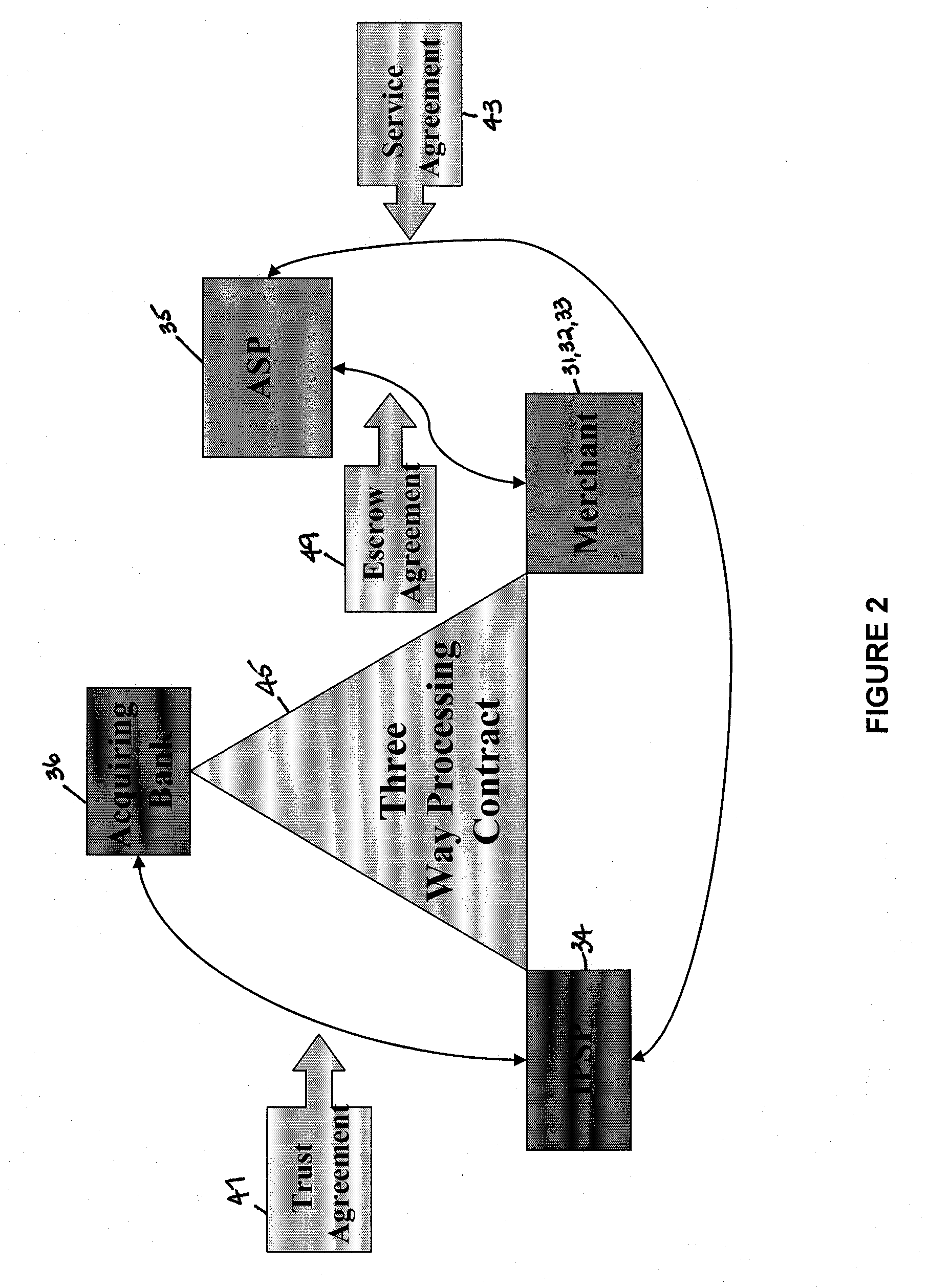

Various embodiments of the invention provide a more secure financial transaction system for e-commerce sectors that (1) more securely processes payment transactions, (2) helps to protect merchants and banks against fraudulent transactions, money laundering, and underage gambling, and (3) helps to limit other abuses in areas of e-commerce that are perceived to pose special risks, such as Internet gaming, travel, and consumer purchasing of electronic goods. To accomplish the above goals, various embodiments of the financial transaction system (1) establish operating and transaction processing protocols for merchants, Internet payment service providers, acquiring banks, and card schemes and (2) provide automated systems for monitoring and securely processing payment and financial transactions.

Owner:TRUST PAYMENTS LTD

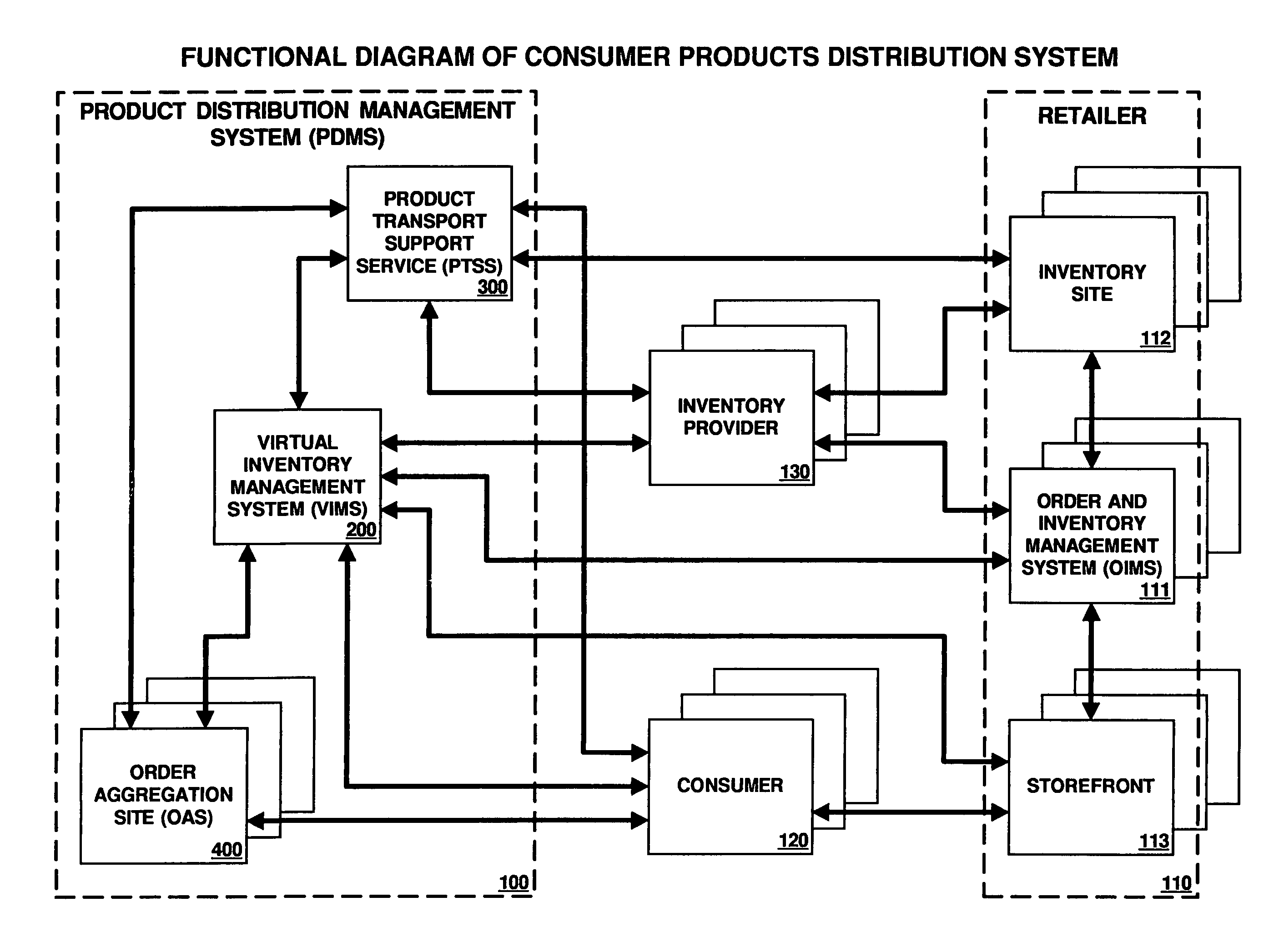

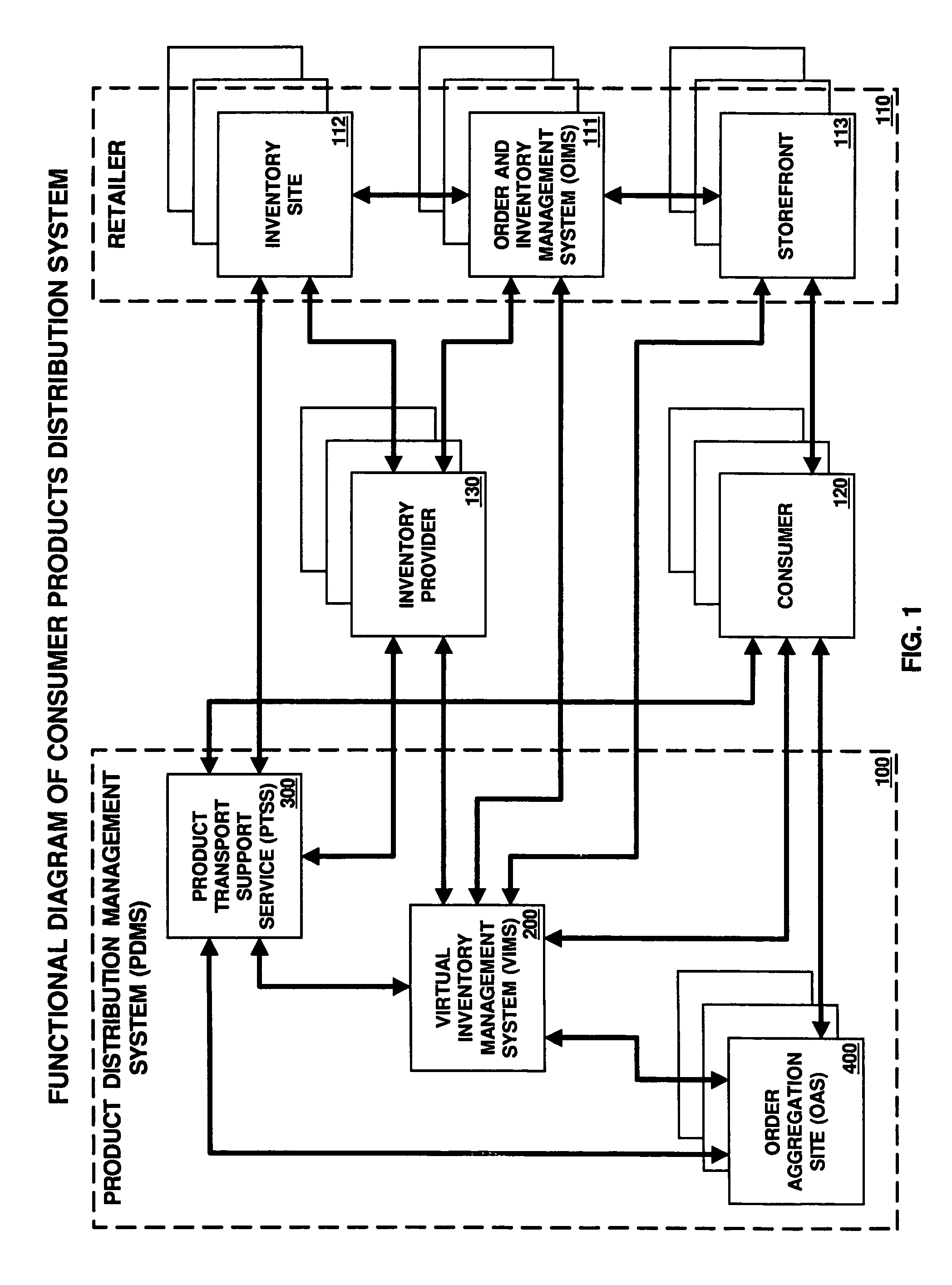

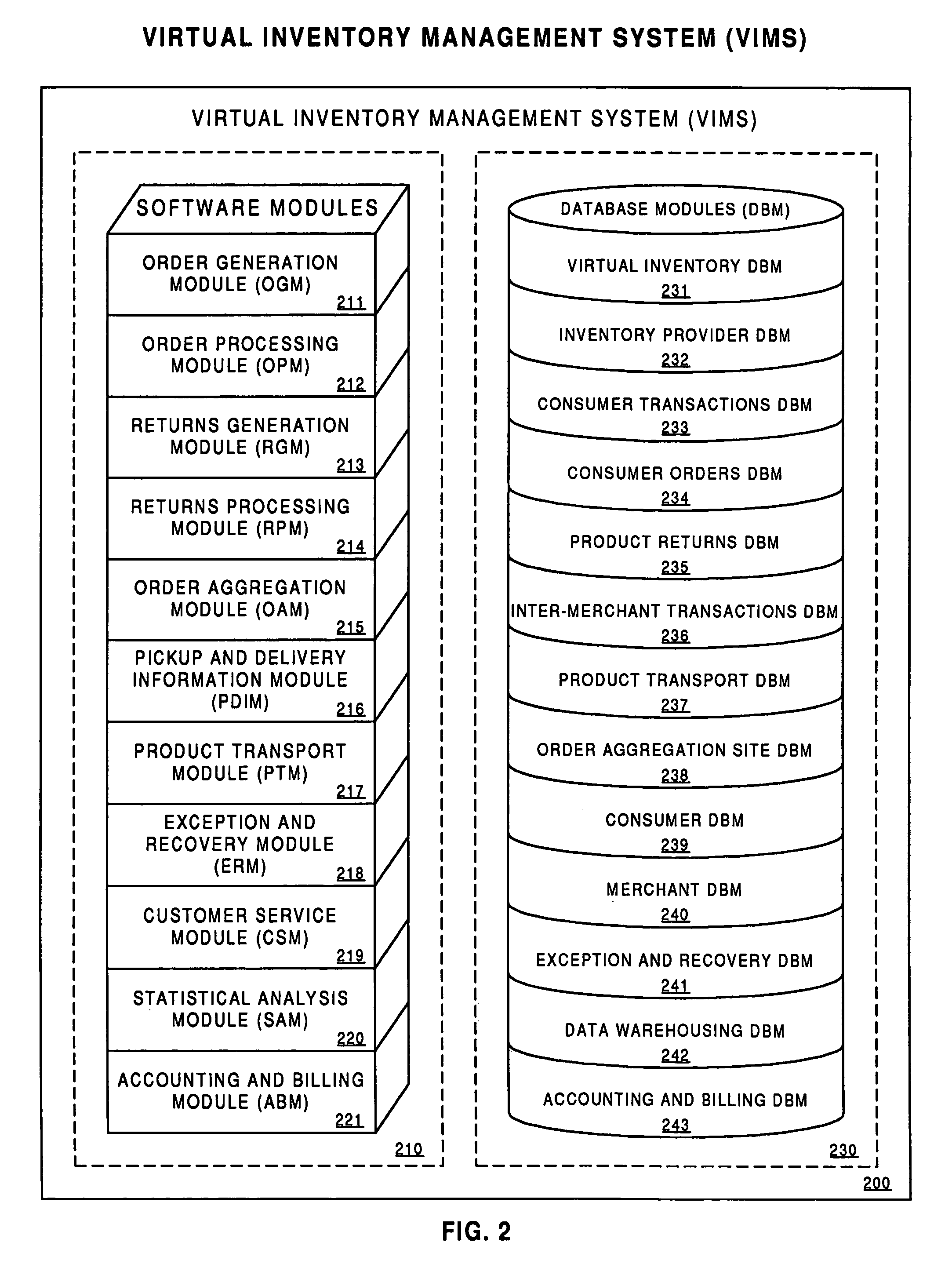

Consumer products distribution system

A real-time transaction processing Consumer Products Distribution System (PDMS) reduces distribution costs, facilitates the distribution of products to consumers and makes online shopping practical. The PDMS integrates Collaborative Inventory Sharing, Order Aggregation, Consumer Predictive Purchasing, Product Transport Support Service, Display Shops, Uniform Consumer Preference Codes, Integrated Virtual Technical Support Centers, and other convenient features. Consumers purchase products through web sites of local and remotely located retailers preferably using Predictive Purchasing. The items purchased from multiple retailers are aggregated at a consumer selected Order Aggregation Site (OAS) based upon a consumer specified schedule. The consumer can pick up the aggregated orders at the selected OAS or have the aggregated orders delivered to a residence. Commercial carriers process consumer parcels at OASs where they are combined with Aggregated Orders for pickup or delivery. Consumers are given incentive discounts to promote the use of Predictive Purchasing, which significantly improves supply chain productivity.

Owner:FRANCO HECTOR

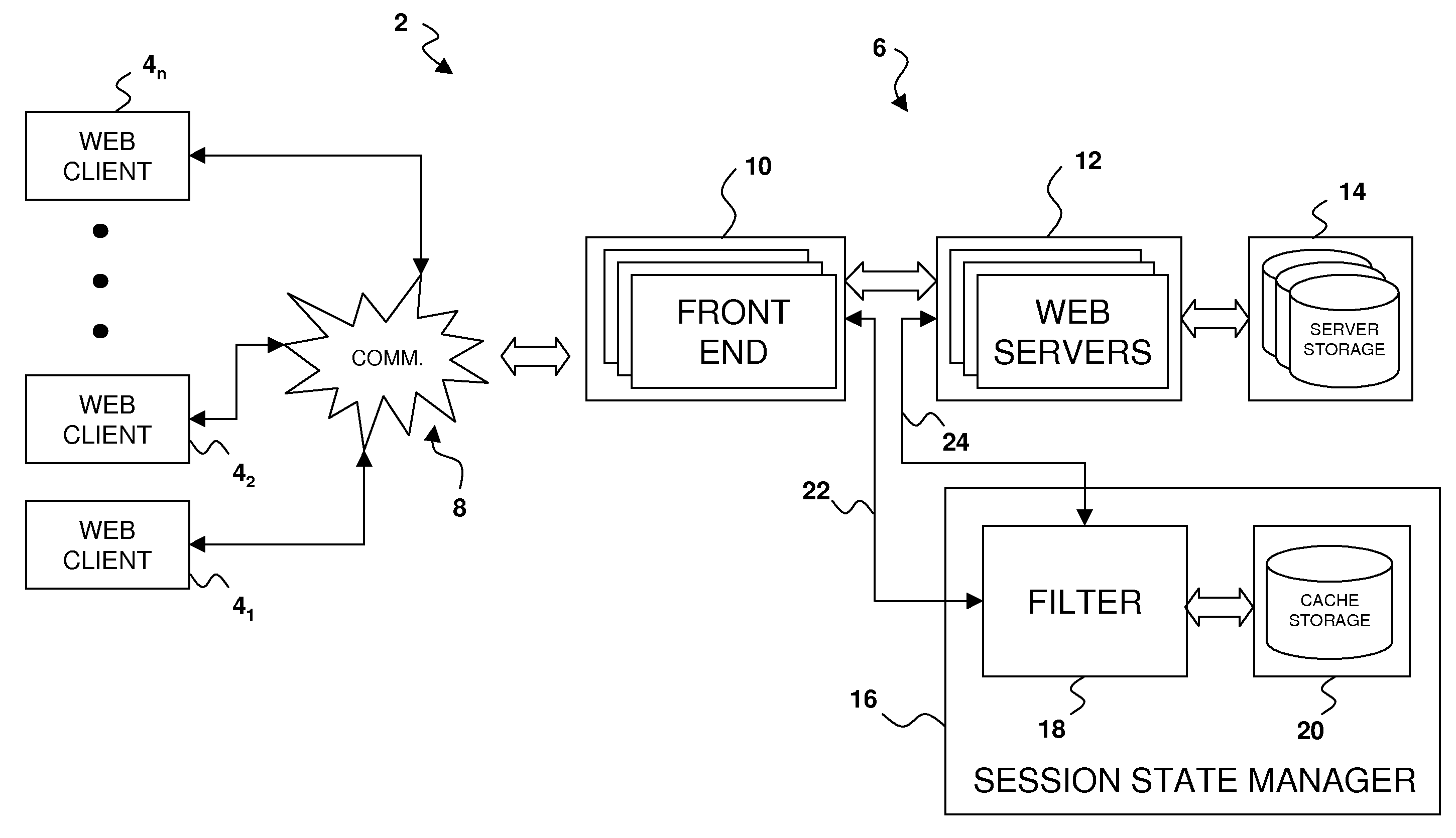

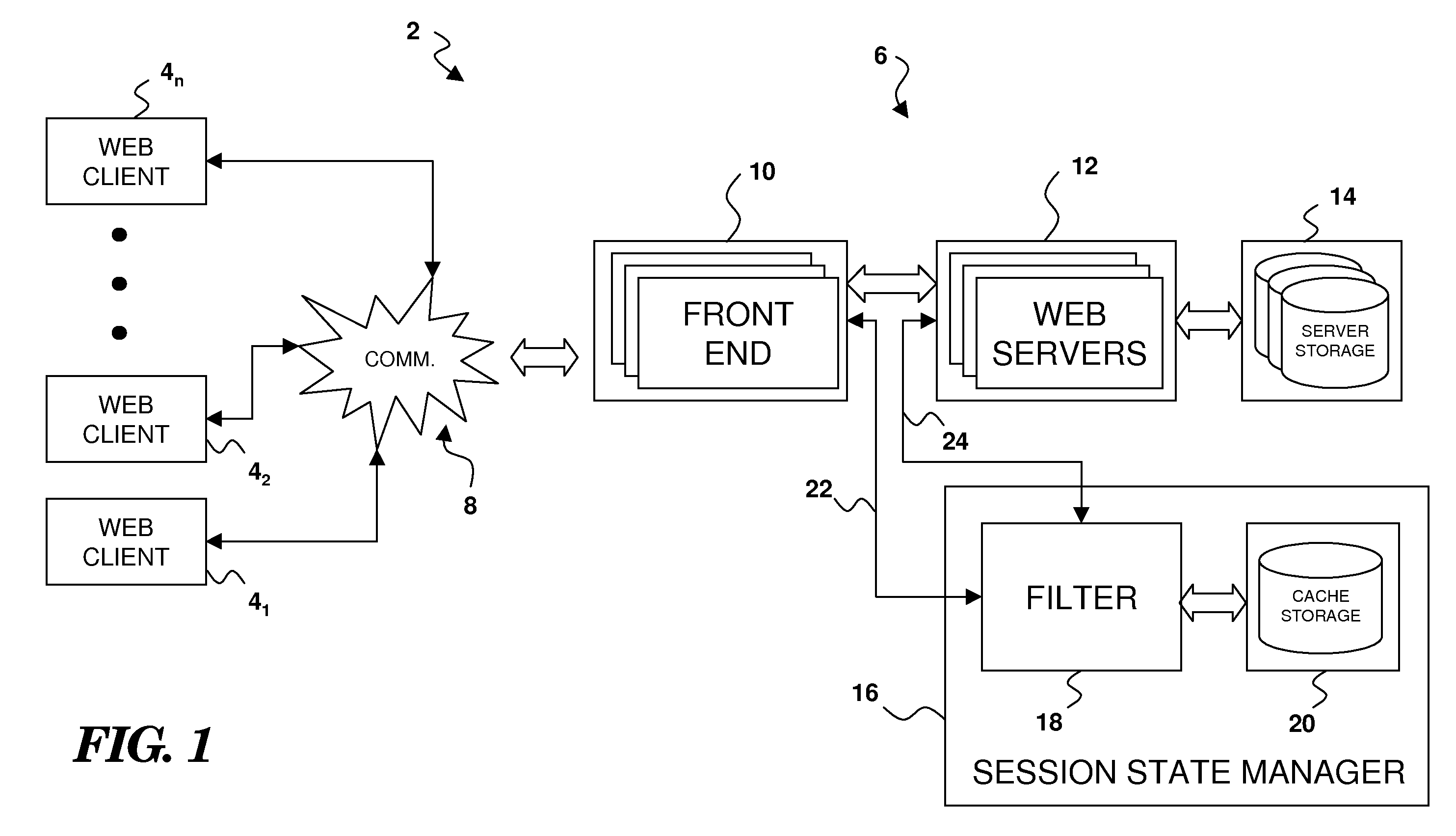

Managing Session State For Web Applications

Owner:IBM CORP

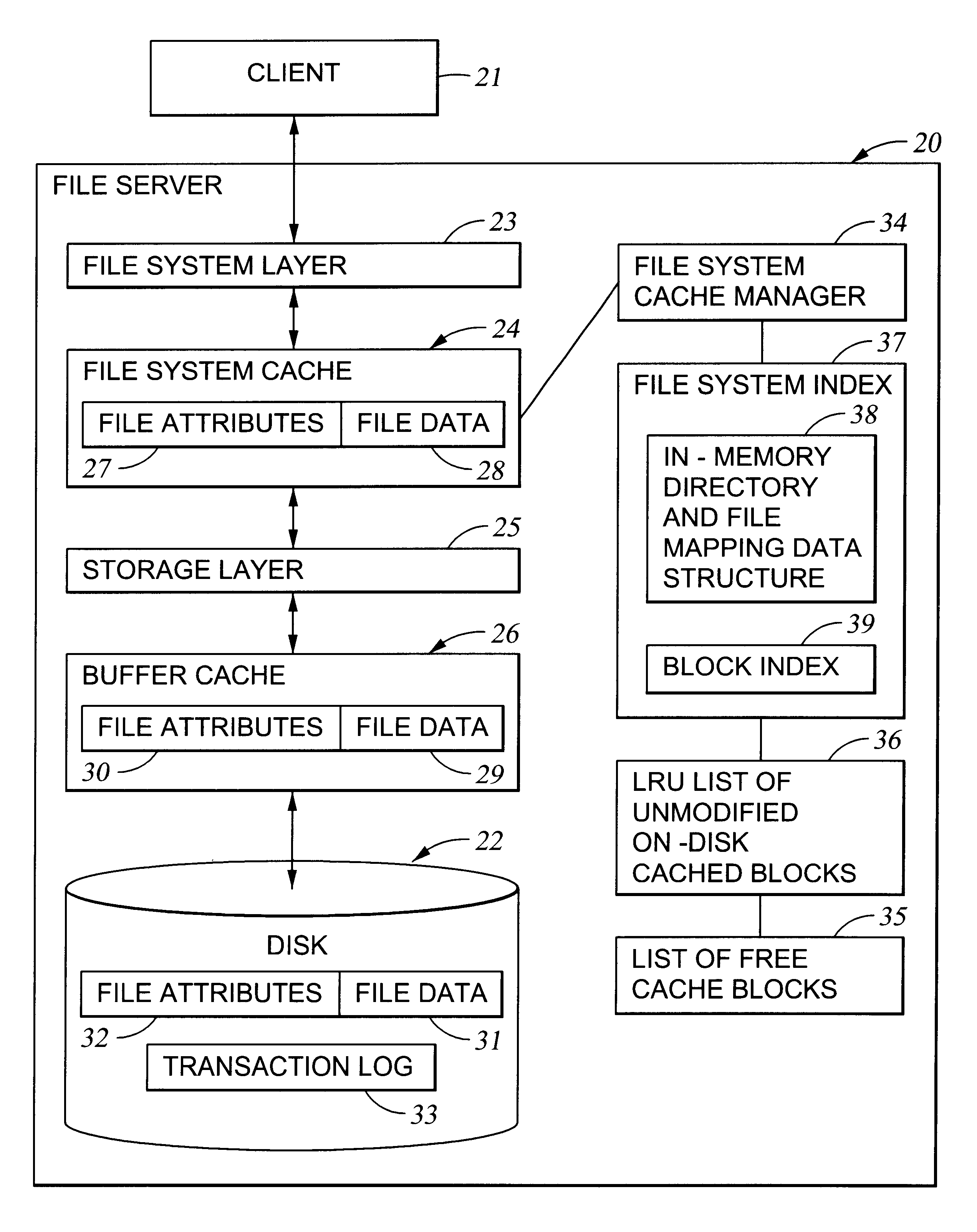

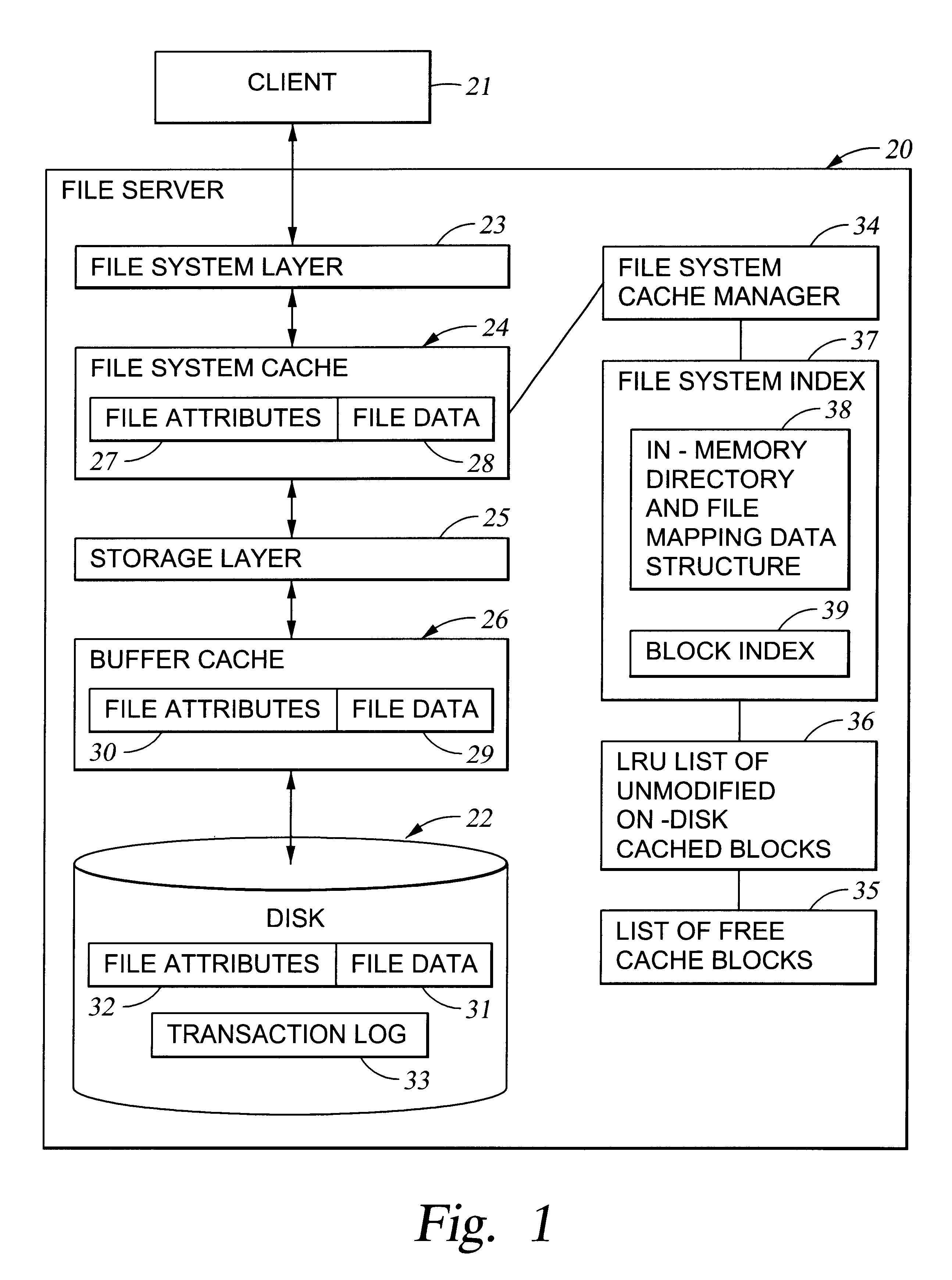

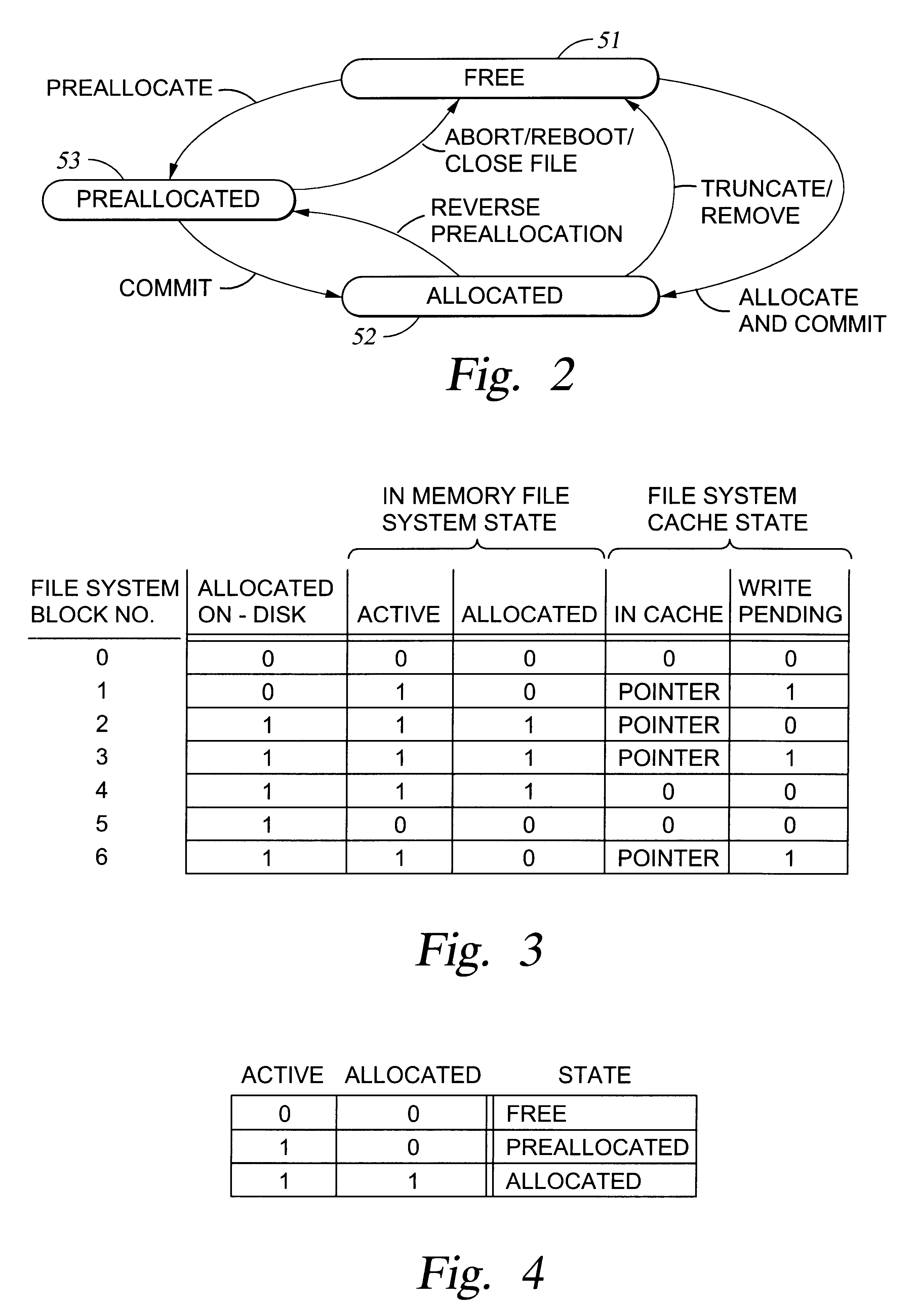

Preallocation of file system cache blocks in a data storage system

InactiveUS6571259B1Data processing applicationsSpecial data processing applicationsOperational systemTransaction log

A file server provides transaction processing capabilities previously supplied by the operating system of a host computer. On-disk file system metadata is changed only at commit time, and a transaction log protects the transition. The disk state can only be a consistent state, resulting from a commit operation. All disk-block reservation and pre-allocation mapping are in the memory, and after a crash, they are automatically discarded. The file server therefore relieves the client of processing burden and also reduces network traffic. In addition, the file server can more efficiently perform the transaction processing capabilities and reduce the frequency of access to storage by judicious allocation of file system blocks and transfer of file system blocks between file system objects, cache memory, and the transaction log. The differentiation between preallocation states and allocation states of in-memory file system blocks also permits application programs to more efficiently transfer data between files.

Owner:EMC IP HLDG CO LLC

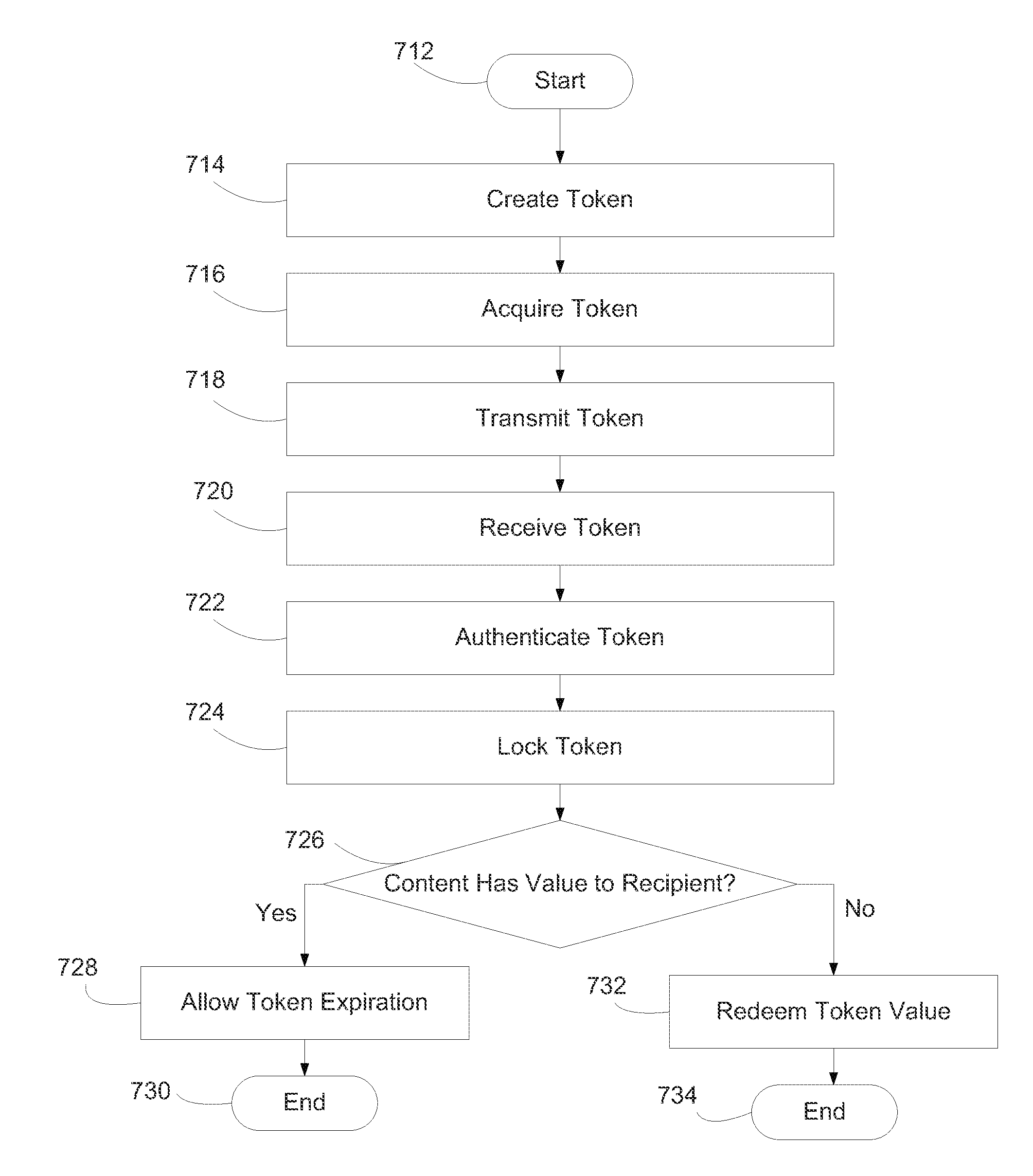

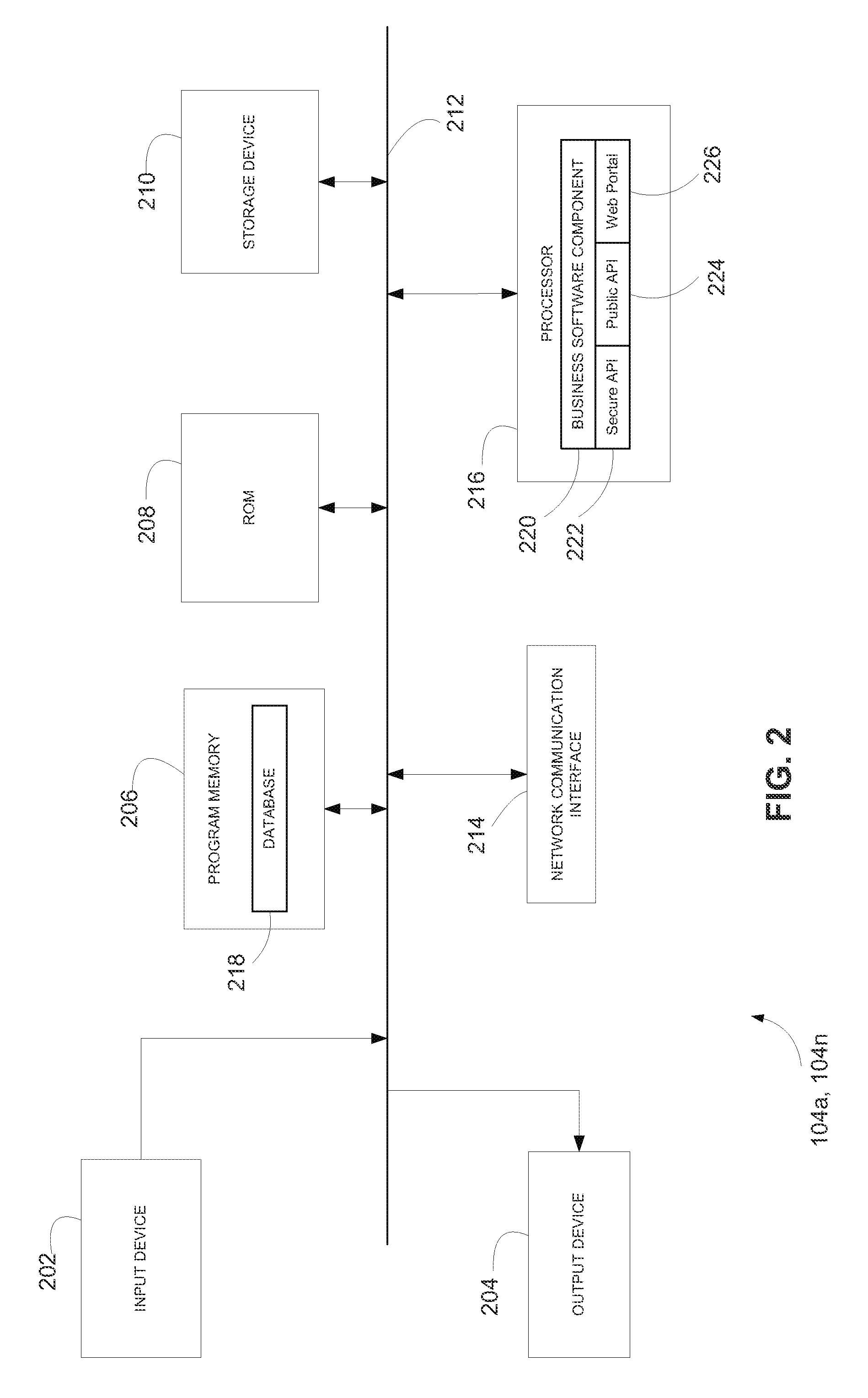

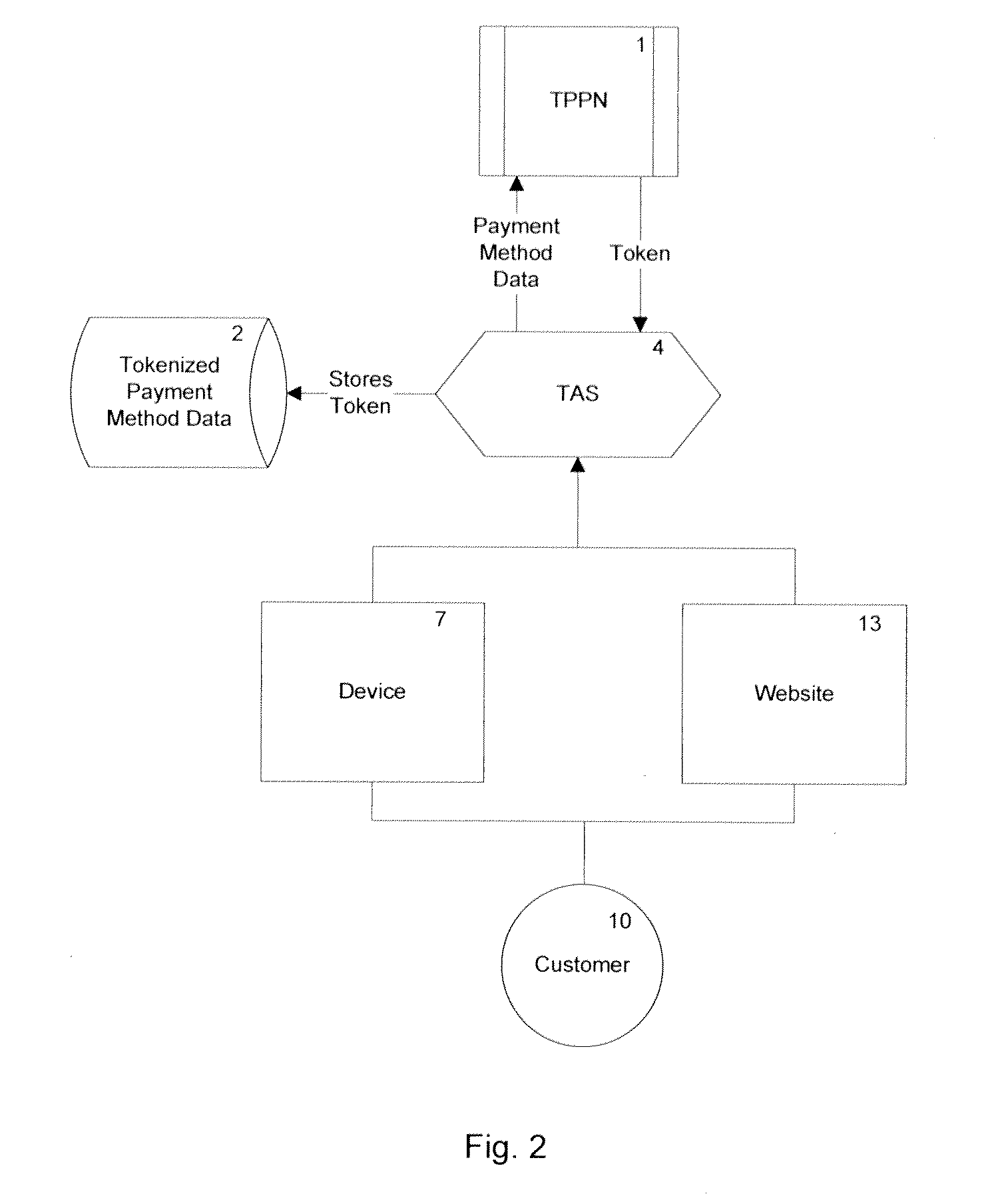

Method and systems for generating and using tokens in a transaction handling system

A method and systems for generating and using transaction tokens including a plurality of interfaces for communication over a network, the plurality of interfaces communicatively coupled to a plurality of information sending devices and a plurality of information receiving devices, at least one database including a token data table and a user profile table, the token data table storing at least one token, the at least one token having a user-defined value and a plurality of data fields, and a business software component communicatively coupled to the plurality of interfaces and the at least one database that is operative to receive at least one request from the plurality of interfaces, generate at least one token in response to the at least one request received from the plurality for interfaces, lock the at least one token generated in response to the received at least one request, and redeem the user-defined value of the locked at least one token.

Owner:GIDAH

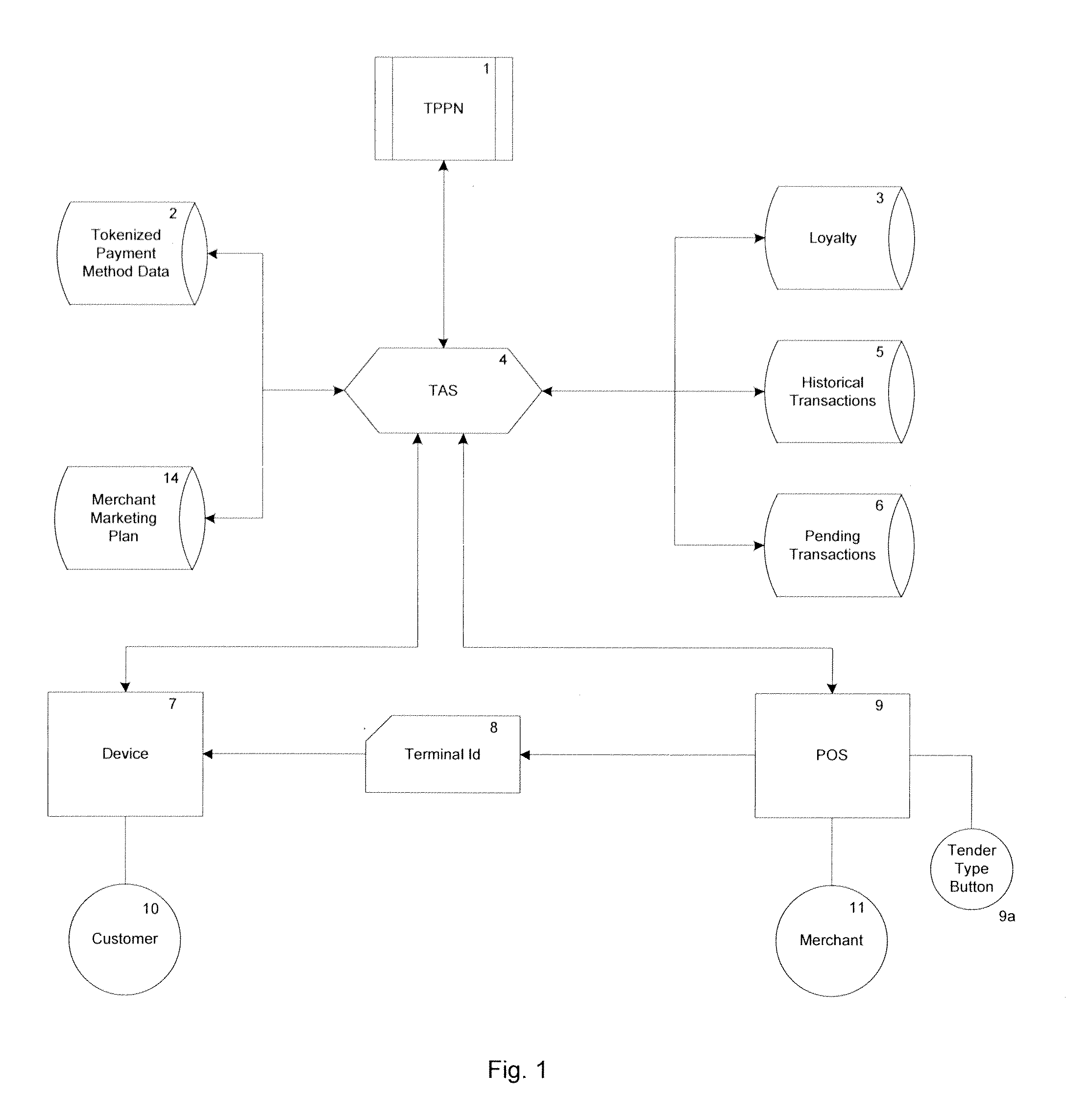

Mobile system and method for payments and non-financial transactions

InactiveUS20120016731A1Readily availableLow costBuying/selling/leasing transactionsPoint-of-sale network systemsVirtual terminalPayment transaction

A method and system for mobile commerce, communication, and transaction processing to real-world POS. web, e-commerce, virtual terminal, mobile personal digital assistant, mobile phone, mobile device, or other computer based transactions involving either one or both financial and non-financial such as loyalty based transactions as a mobile payment system is described. One embodiment comprises using a mobile phone via a consumer mobile software application (CMA) in lieu of a consumer card (examples include physical, virtual, or chips) to conduct payment transactions in the Real or Virtual World of commerce. An embodiment is related to making payments to real-world stores via having the CMA on a mobile device on behalf of the consumer present to conduct transactions and no physical card required.

Owner:PAYME

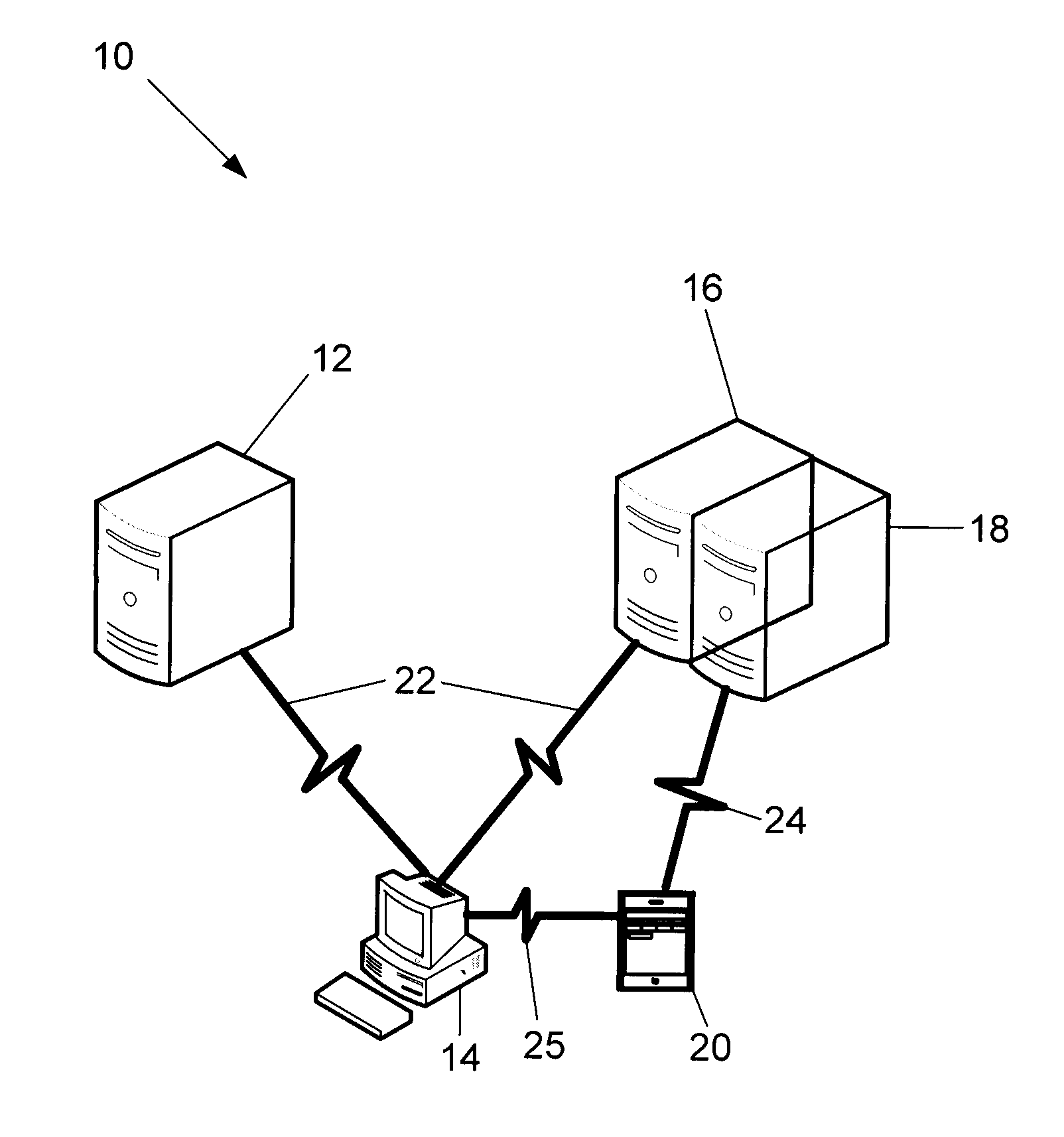

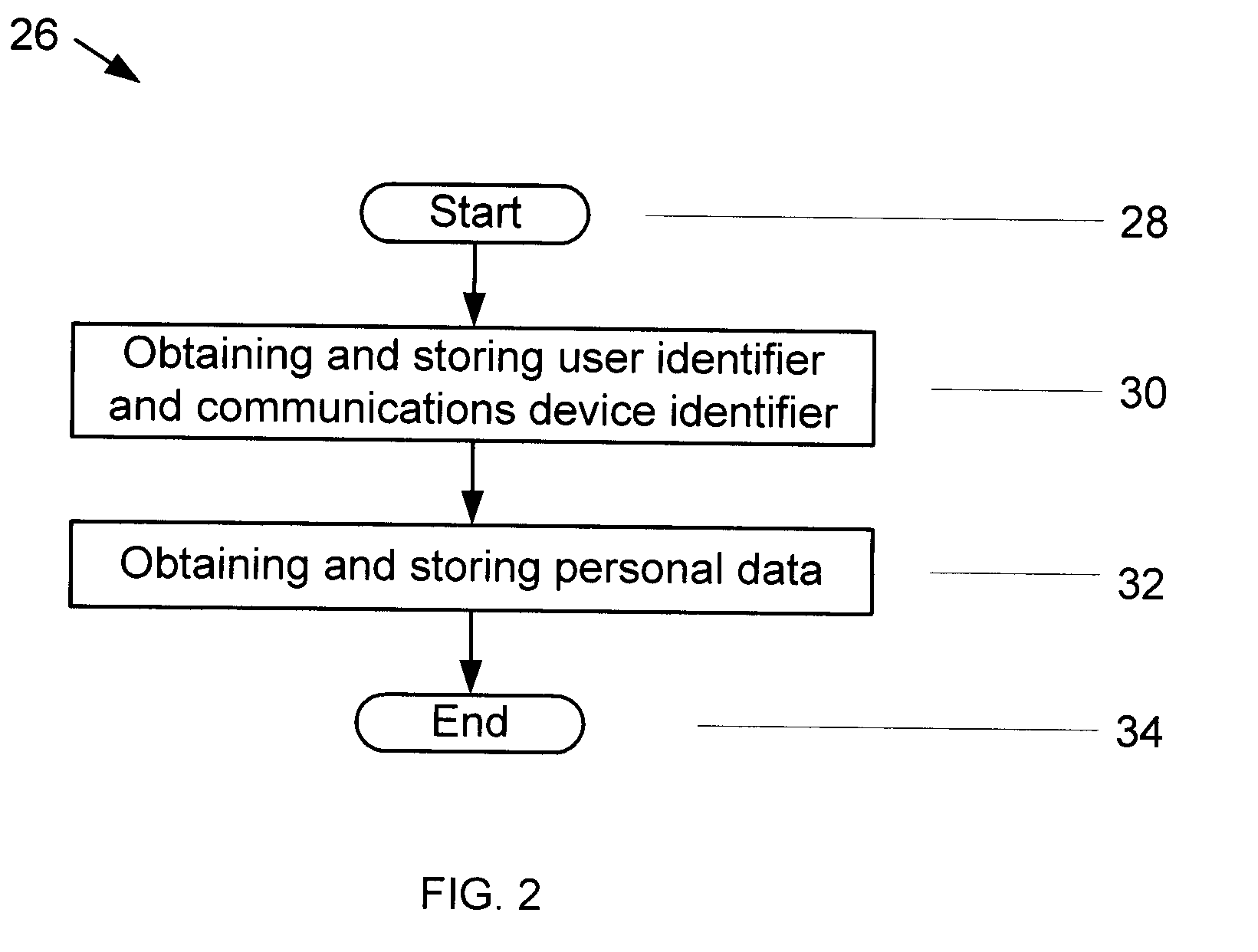

Methods and systems for authenticating users

ActiveUS20110035788A1Reduce transaction riskReduce riskDigital data processing detailsUser identity/authority verificationWorkstationOne-time password

A method of authenticating users to reduce transaction risks includes indicating a desire to conduct a transaction, inputting information in a workstation, and determining whether the inputted information is known. Moreover, the method includes determining a state of a communications device when the inputted information is known, and transmitting a biometric authentication request from a server to an authentication system when the state of the communications device is enrolled. Additionally, the method includes obtaining biometric authentication data in accordance with a biometric authentication data capture request with the communications device, biometrically authenticating the user, generating a one-time pass-phrase and storing the one-time pass-phrase on the authentication system when the user is authenticated, comparing the transmitted one-time pass-phrase against the stored one-time pass-phrase, and conducting the transaction when the transmitted and stored one-time pass-phrases match.

Owner:DAON TECH

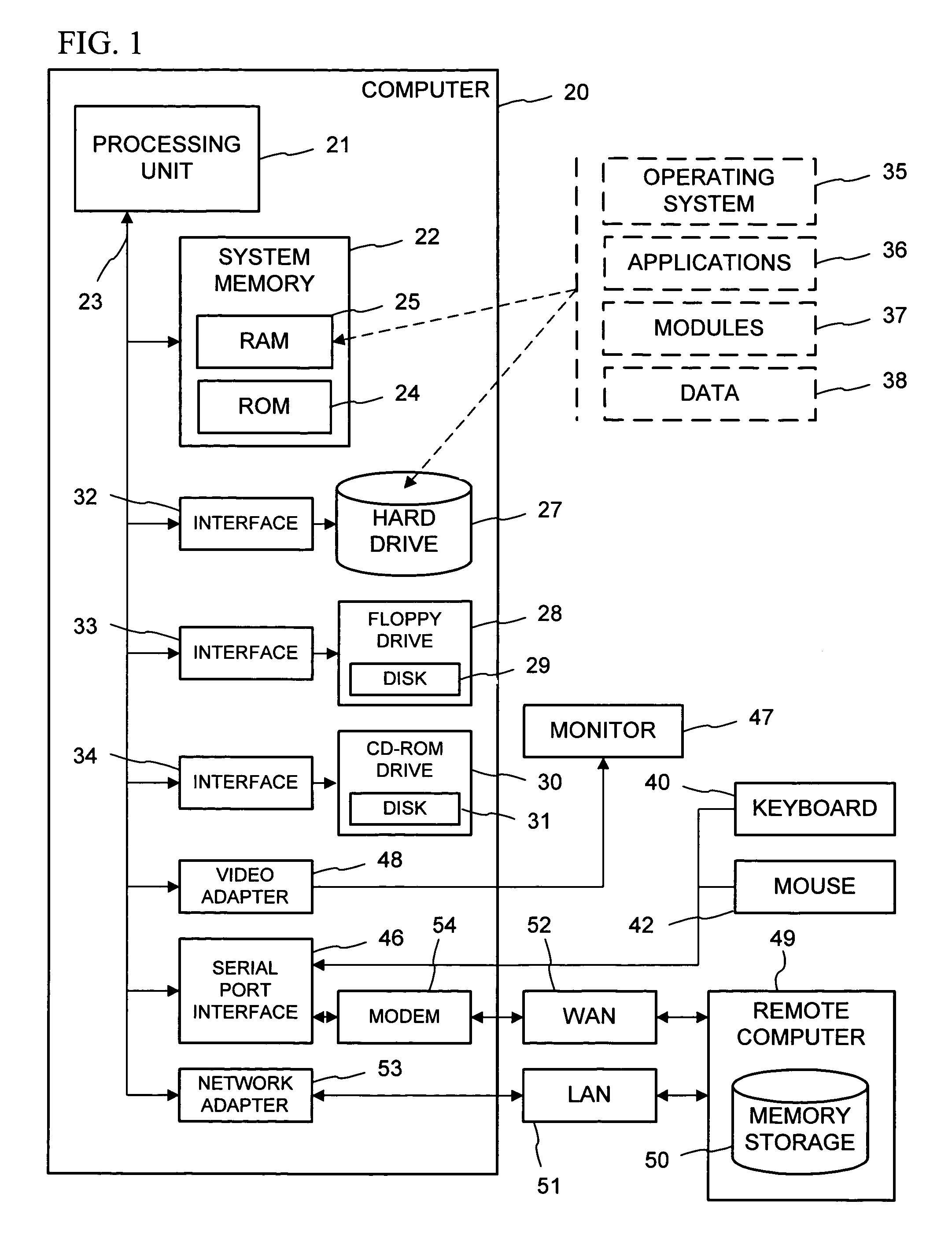

Software component execution management using context objects for tracking externally-defined intrinsic properties of executing software components within an execution environment

InactiveUS7076784B1Insufficient flexibilityData processing applicationsSpecific program execution arrangementsManagement objectApplication software

A run-time executive of an object management system for managing execution of software components in an object execution environment uses a component context object to store intrinsic context properties related to an associated component. The run-time executive maintains an implicit association of the component context object with the application component. For example, the context properties can include a client id, an activity id, and a transaction reference. The component context object also provides an interface accessible to the associated component, with member functions for use in transaction processing, in creating additional other application components inheriting component's context properties, and in access control based on abstract user classes (roles).

Owner:MICROSOFT TECH LICENSING LLC

Identification and management of fraudulent credit/debit card purchases at merchant ecommerce sites

InactiveUS20080046334A1Reduce exposureFinanceDigital data processing detailsE-commerceOnline trading

Transaction processing of online transactions at merchant sites determines the likelihood that such transactions are fraudulent, accounting for unreliable fields of a transaction order, which fields do not reliably identify a purchaser. A scoring server using statistical model uses multiple profiles associated with key fields, along with weights to indicate the degree to which the profiles identify the purchaser of the transaction.

Owner:FAIR ISAAC & CO INC

Systems and methods for determining regulations governing financial transactions conducted over a network

Various embodiments of the invention provide a more secure financial transaction system for e-commerce sectors that (1) more securely processes payment transactions, (2) helps to protect merchants and banks against fraudulent transactions, money laundering, and underage gambling, and (3) helps to limit other abuses in areas of e-commerce that are perceived to pose special risks, such as Internet gaming, travel, and consumer purchasing of electronic goods. To accomplish the above goals, various embodiments of the financial transaction system (1) establish operating and transaction processing protocols for merchants, Internet payment service providers, acquiring banks, and card schemes and (2) provide automated systems for monitoring and securely processing payment and financial transactions.

Owner:TILLY BAKER +1

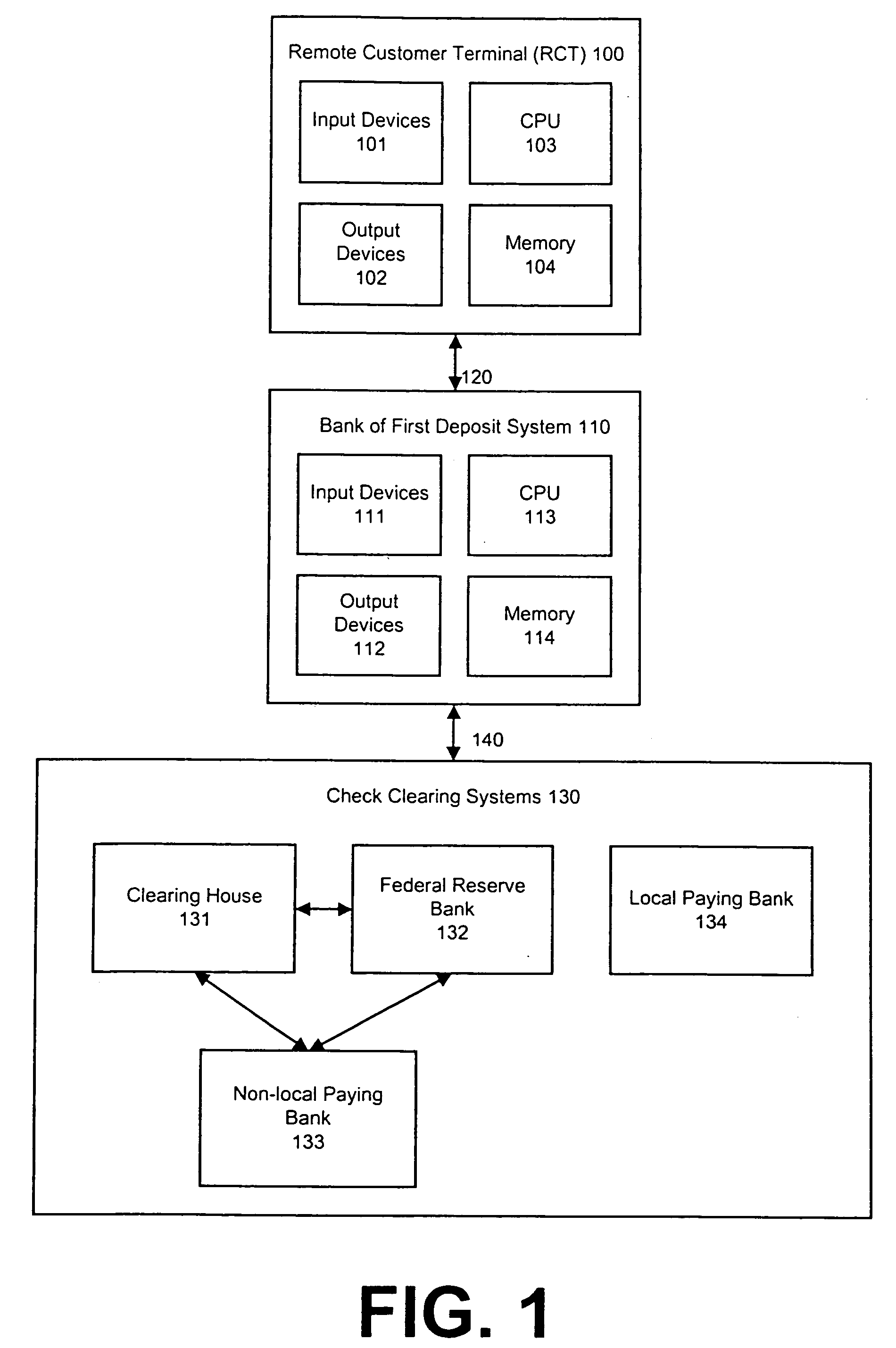

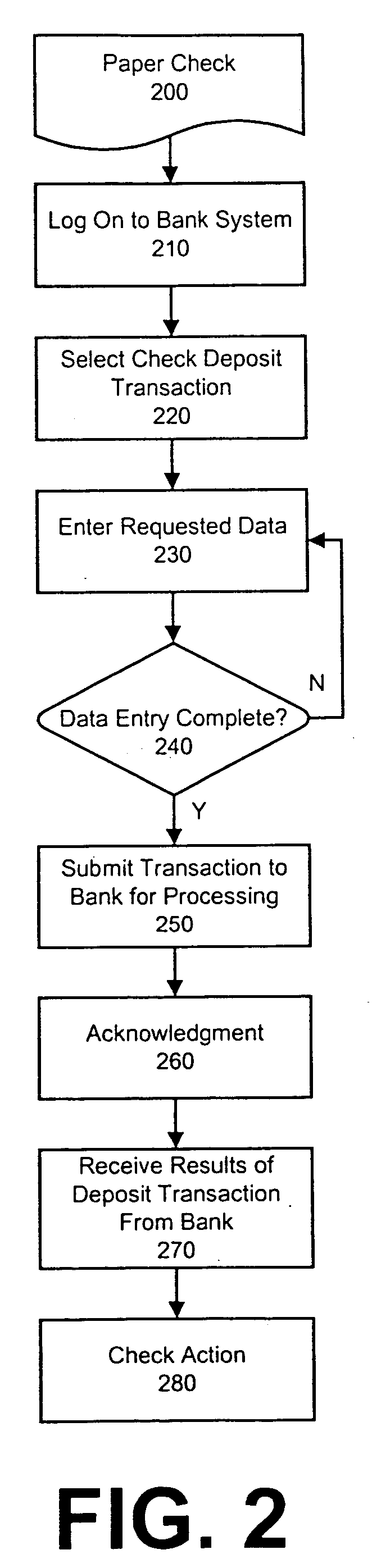

System and method for electronic deposit of third-party checks by non-commercial banking customers from remote locations

InactiveUS20050267843A1Level of independenceFinanceCo-operative working arrangementsThird partyCheque

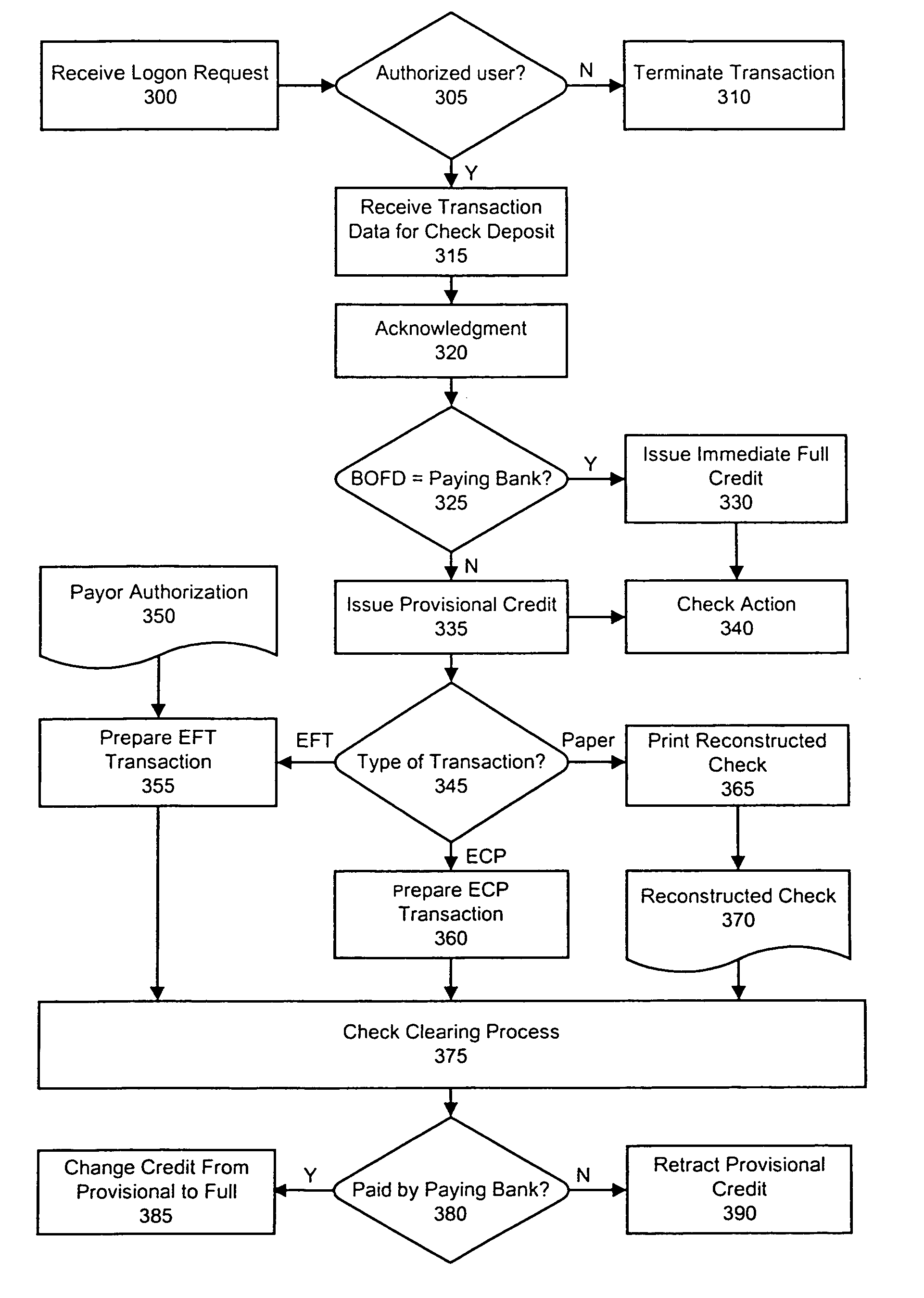

A system and method for initiating a deposit transaction, where the depositor is a non-commercial banking customer located at a remote location, and where the item to be deposited is a paper check from a third party, payable to the depositor. The enabling system features a Remote Customer Terminal (RCT) with certain input devices, connected to a bank system. The image and / or other data sent from the RCT to the Bank of First Deposit (BOFD) may be processed by conversion to Electronic Funds Transfer (EFT), via Electronic Check Presentment (ECP), or via check reconstruction. The new system and method provide convenience and improved transaction processing speed compared to other transactions that begin with a third party check.

Owner:BANK ONE CORPORATION

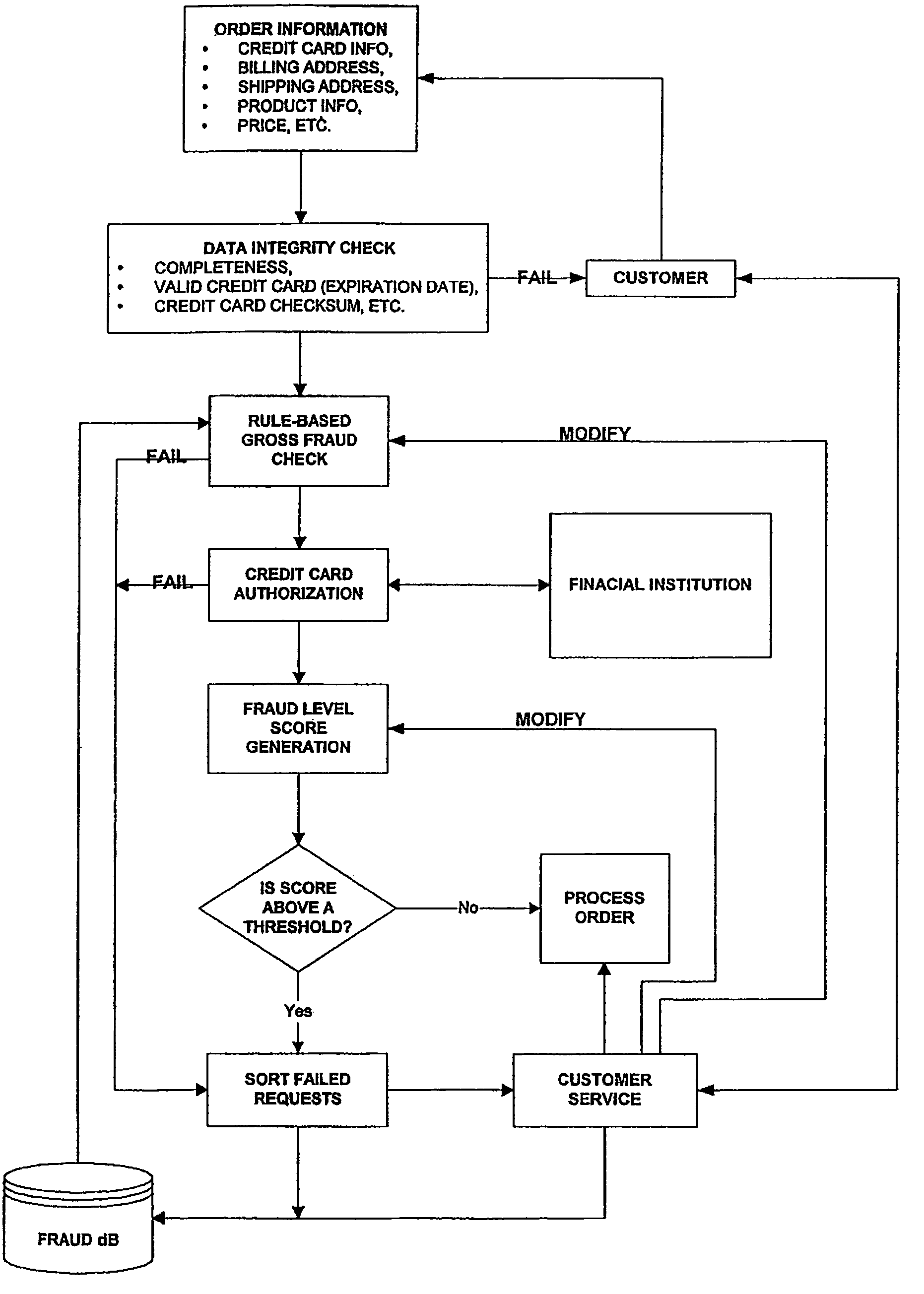

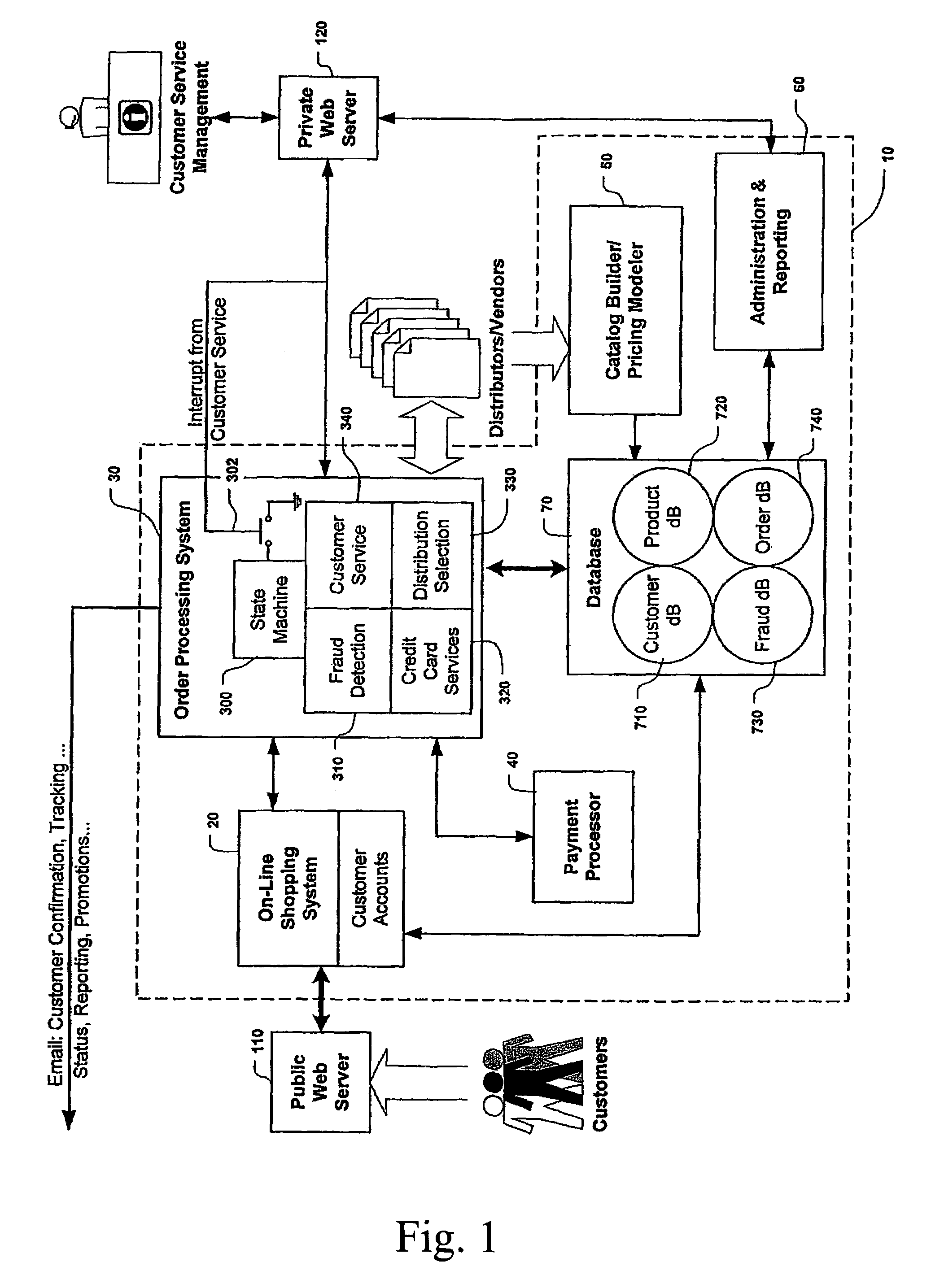

Multi-level fraud check with dynamic feedback for internet business transaction processor

InactiveUS7139731B1Overcome disadvantagesFast processingDiscounts/incentivesFinanceParallel computingInternet business

An Internet business transaction processor of the present invention has a distributed processing architecture which allows the processing load to be distributed among multiple parallel servers. The transaction processor of the present invention provides a virtual store front utilizing “others people's warehouse” approach by using a dynamic distributor selection processing system to select among a plurality of distributors based on flexible rule-based algorithm. Furthermore, a multi-level fraud check processing system allows orders to be processes that would otherwise be discarded to generate a higher yield in sales.

Owner:HARDWARESTREET COM +1

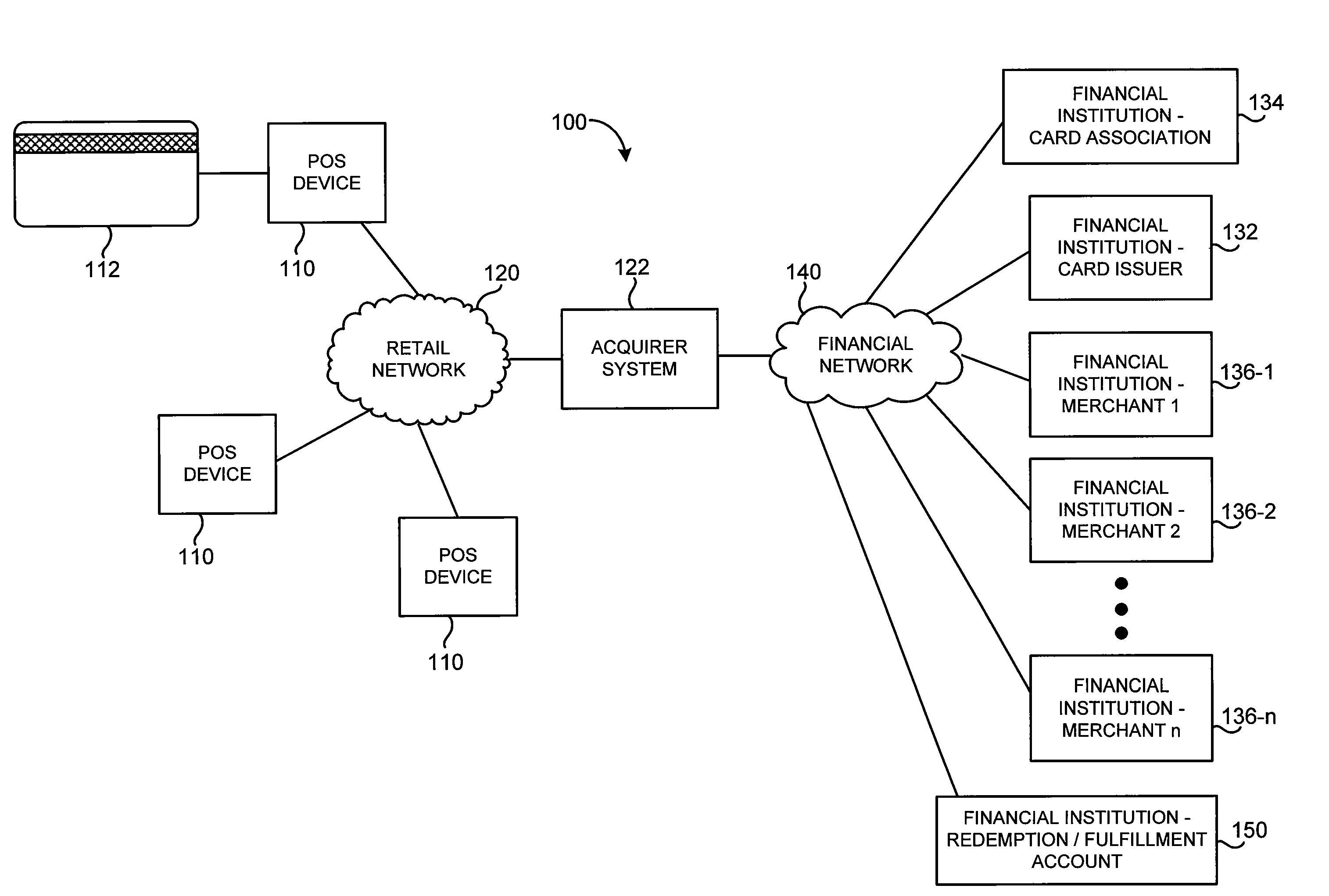

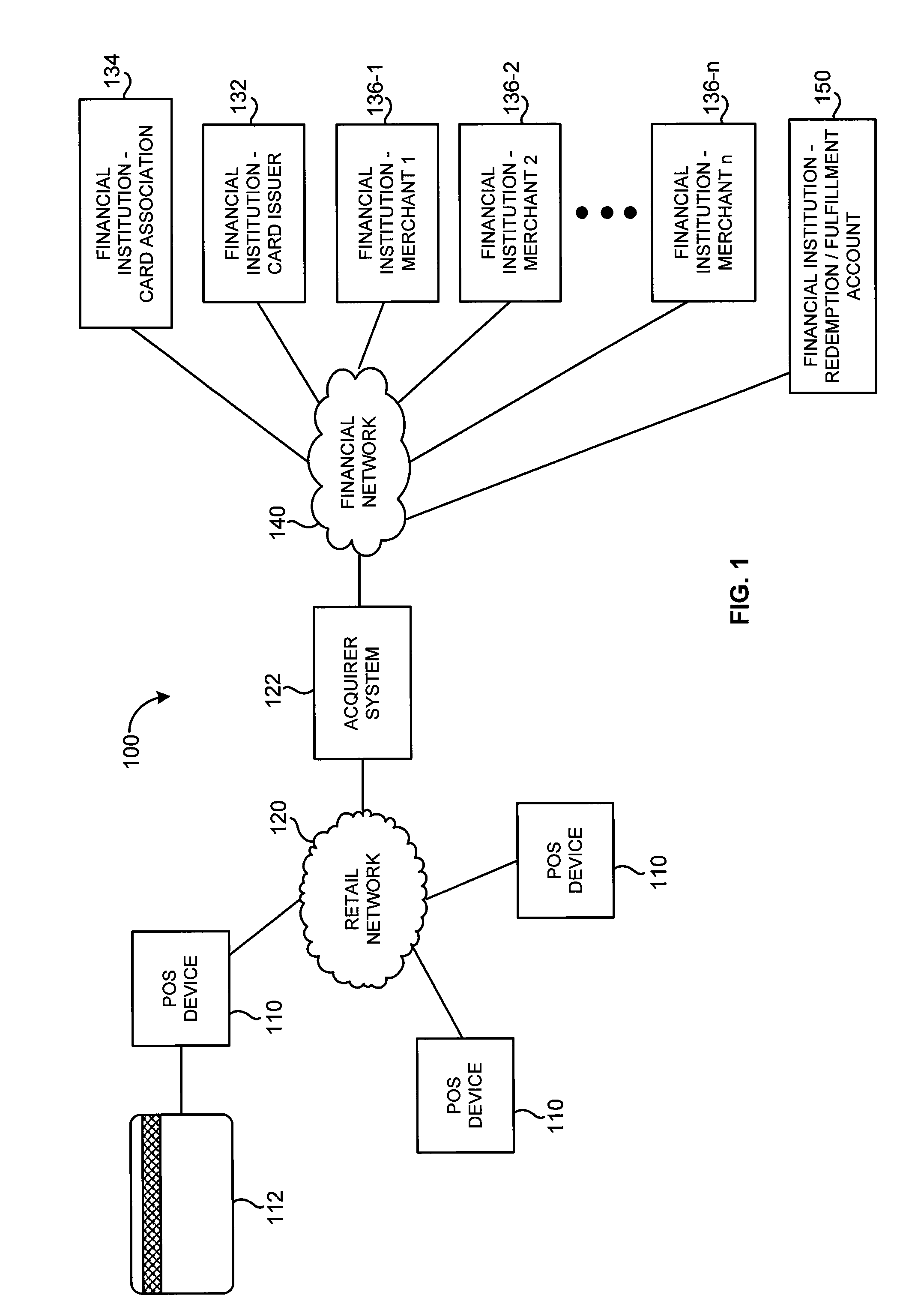

Loyalty reward settlement system and method

A acquirer system used for credit card transaction processing includes a loyalty server to manage issuance of loyalty points as transactions are processed and to provide settlement features. The loyalty server uses loyalty qualifying criteria and assigned point values stored in an associated database. When points are awarded, the loyalty server records the value of the points and electronically transfers amounts from an account of a merchant to an account of the loyalty point issuer. The merchant may be multi-tiered, with the point value allotted between a central merchant organization and individual retail stores.

Owner:FIRST DATA

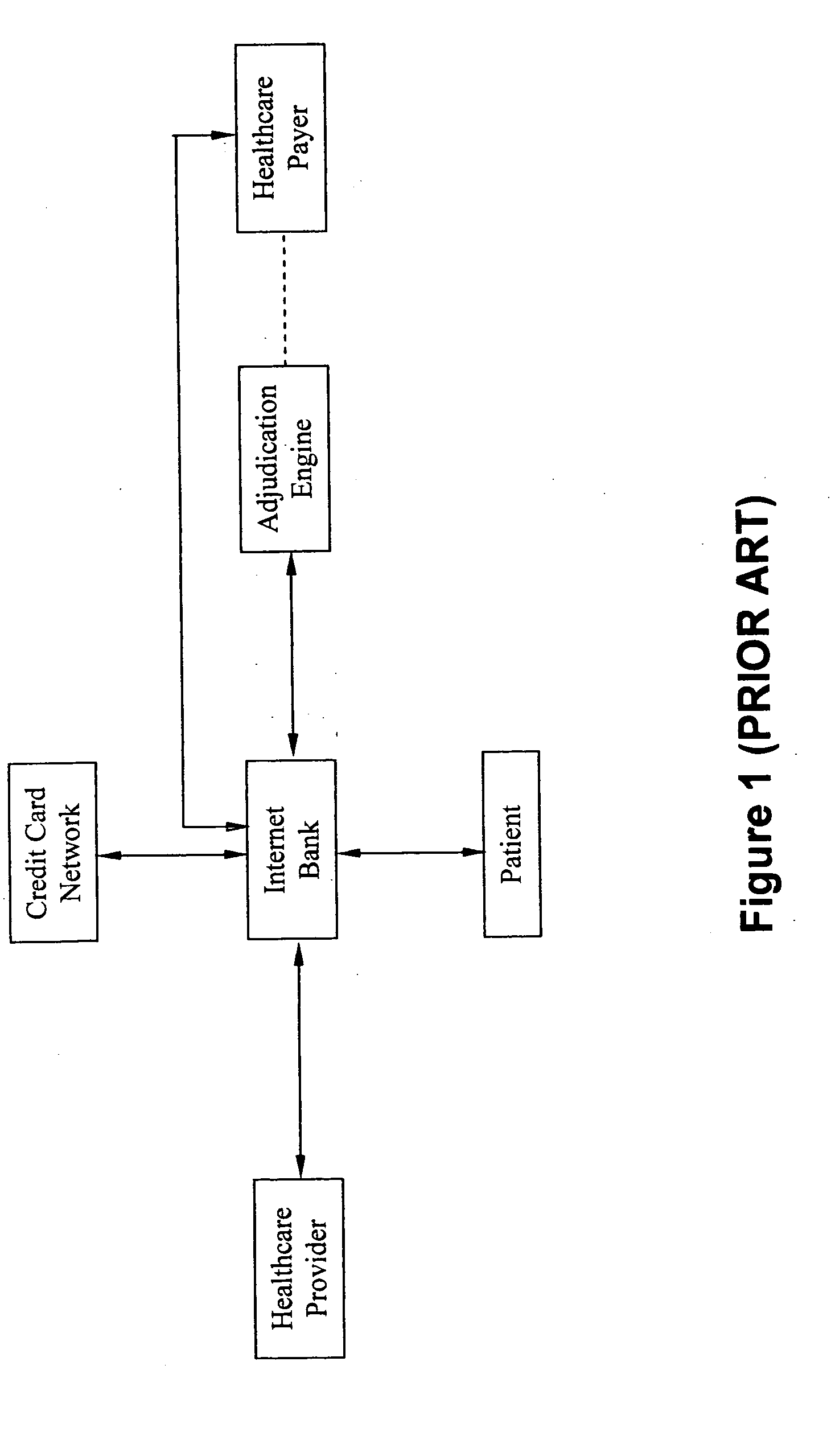

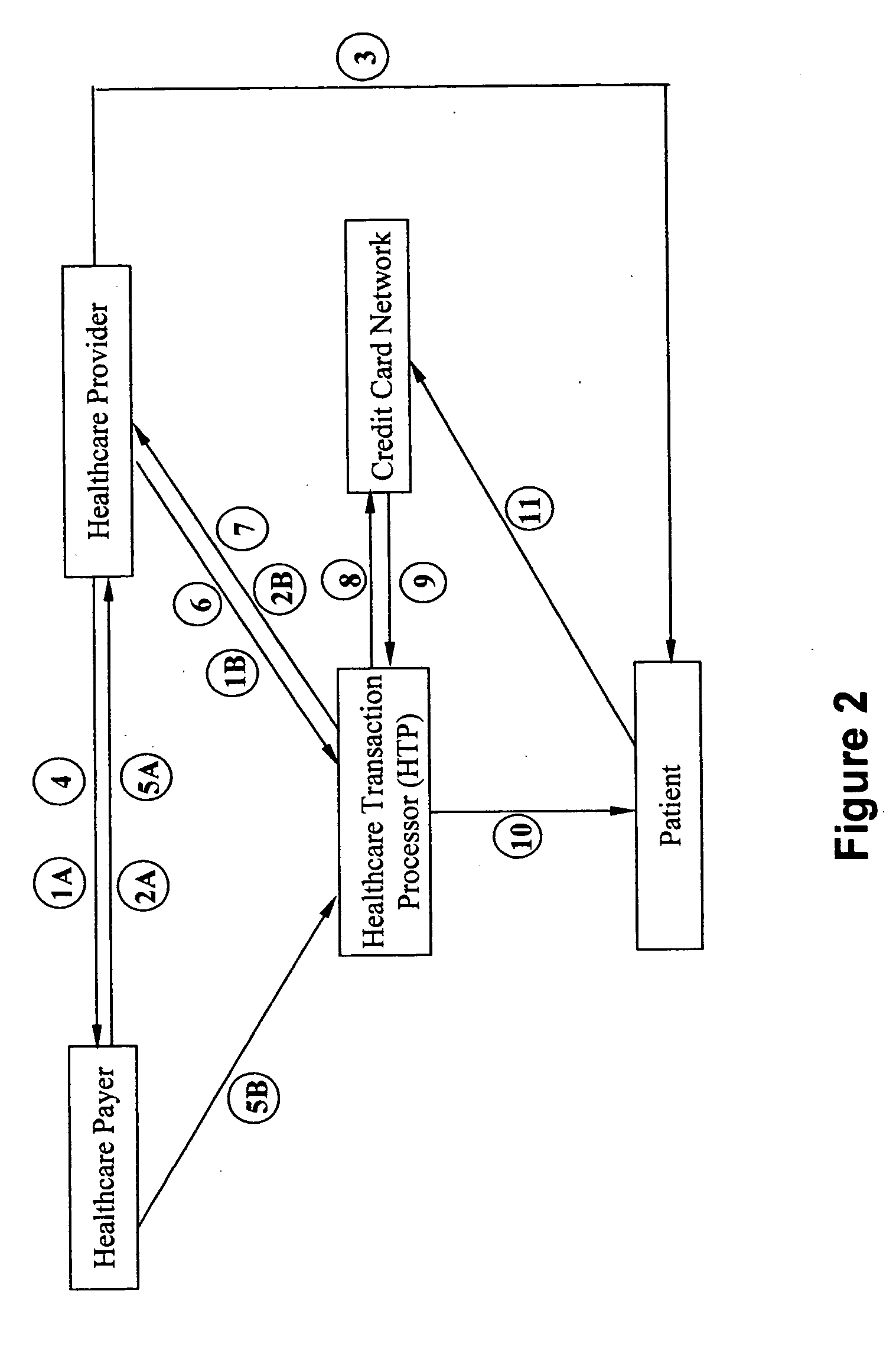

Healthcare system integrated with a healthcare transaction processor, and method for providing healthcare transaction processing services

InactiveUS20050033609A1Improve transaction processing efficiencyFinancePayment architectureThird partyPayment transaction

The present invention relates to a healthcare transaction processor for reviewing and processing healthcare charge statements from the healthcare providers and claim payment statements from the healthcare payers, paying for the patient-responsible portion of the healthcare charges, and providing to the patients consolidated healthcare transaction statements that summarize (1) the total healthcare charges, (2) the payments for the payer-responsible portion of such charges by the healthcare payer, and (3) the payments for the patient-responsible portion of such charges by such third-party healthcare transaction processor. The present invention also relates to a health payment system that performs the dual functions of a conventional healthcare payer and of the healthcare transaction processor as described hereinabove.

Owner:YANG YONGHONG

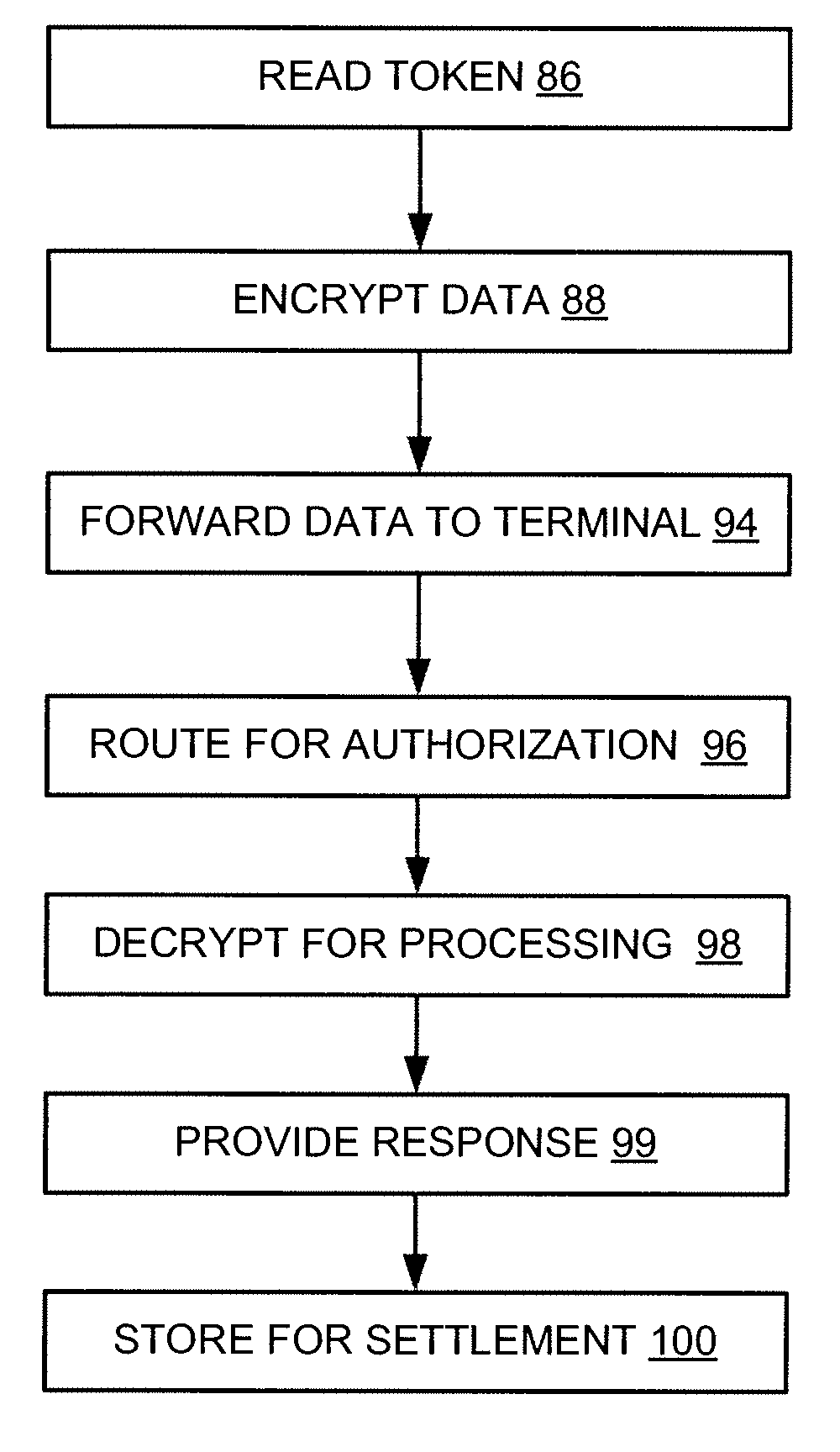

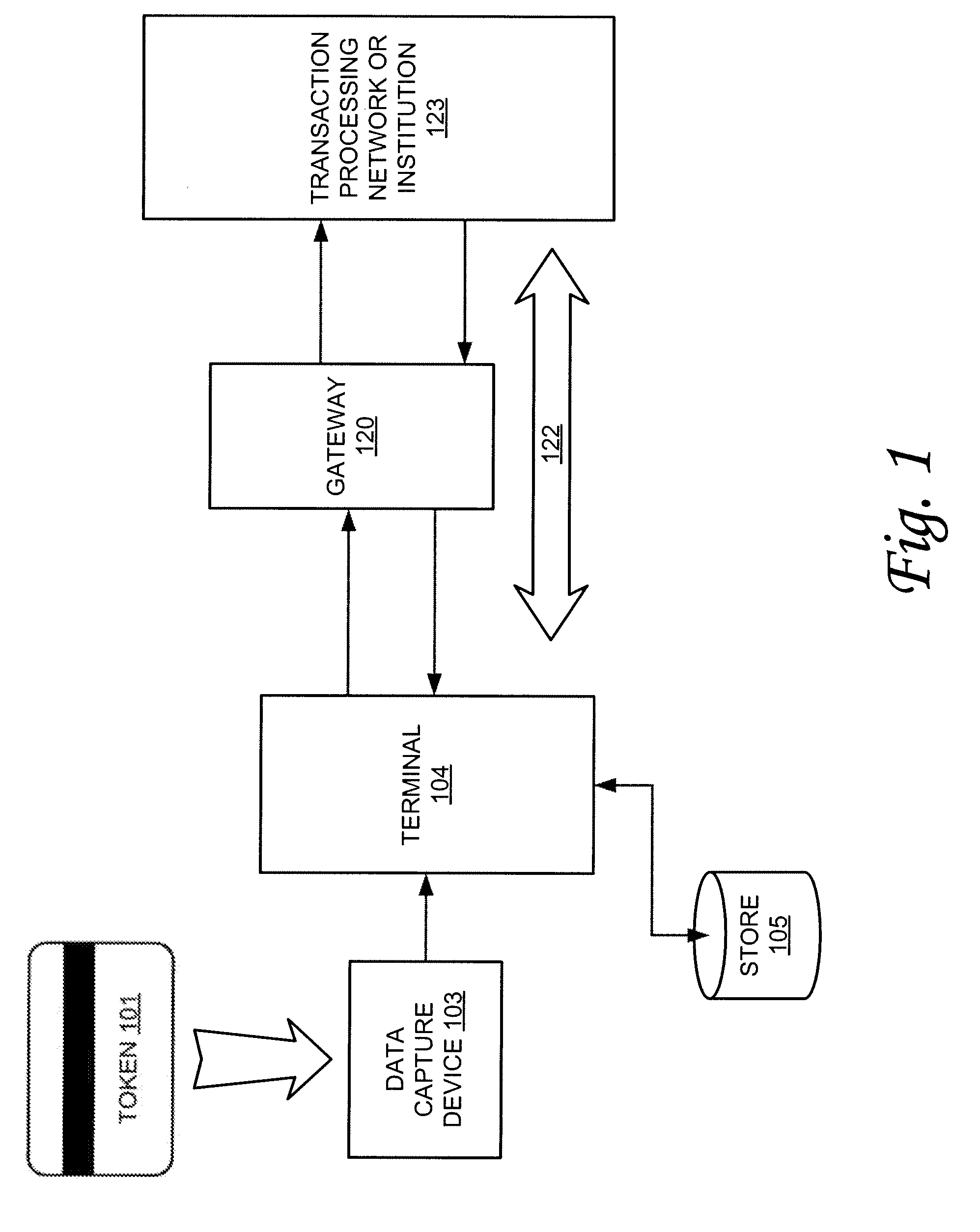

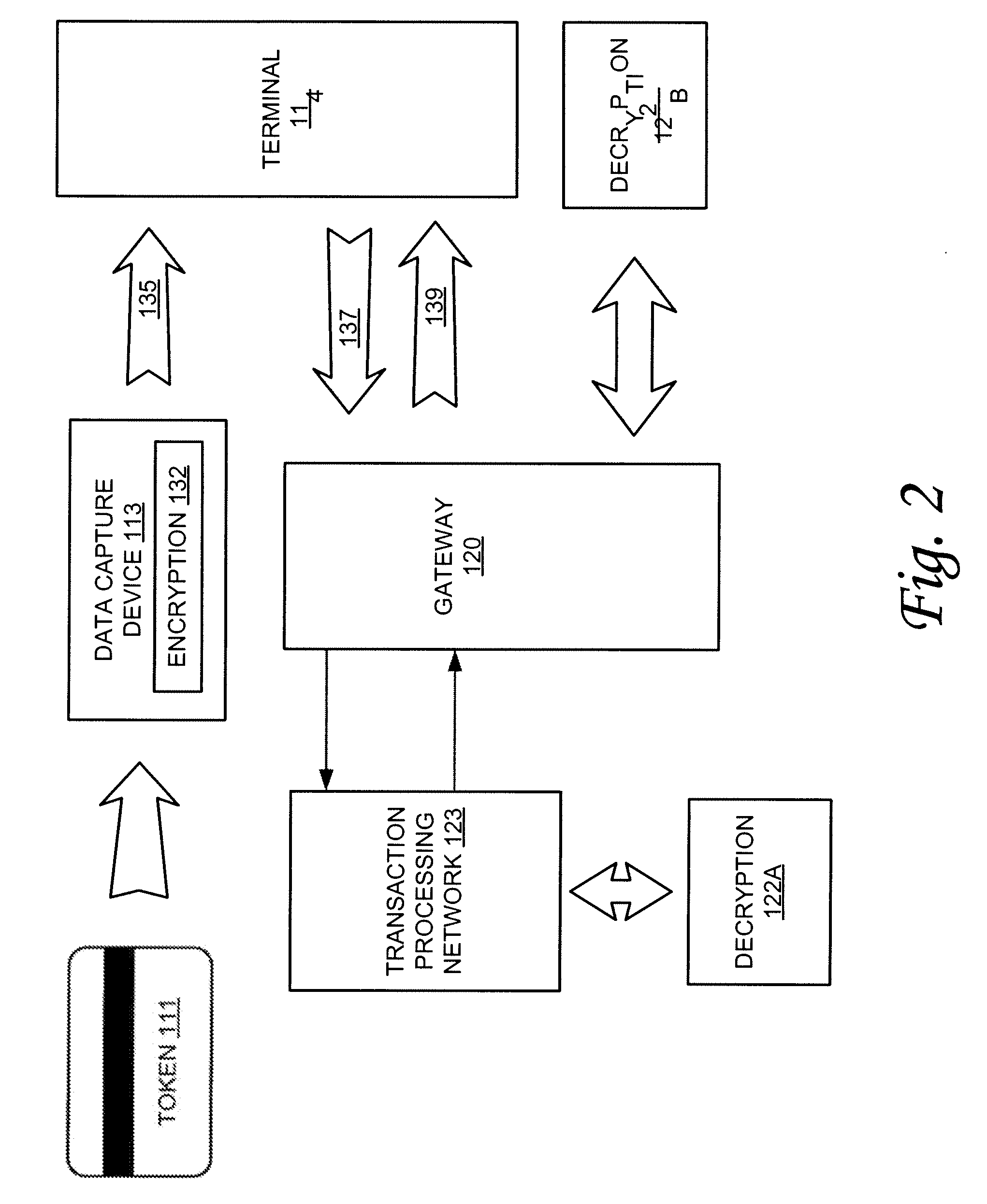

Pin block replacement

ActiveUS20080189214A1Improve securityEasy to upgradeAcutation objectsPoint-of-sale network systemsPlaintextPassword

Systems and methods for performing token transactions are provided. In one embodiment, the invention provides for processing token transactions, including receiving an encrypted password for a debit card transaction, wherein the password was secured using encrypted debit-card information, decrypting the password using encrypted debit-card information for the debit card, recreating the password using actual debit-card information for the debit card, and forwarding the recreated password for subsequent transaction processing. The invention is suitable for implementation with other types of tokens in addition to debit-card tokens as well. The invention can be implemented in a scenario where the password includes a PIN block that is created by combining a clear or encrypted PIN for the token with token information.

Owner:VERIFONE INC

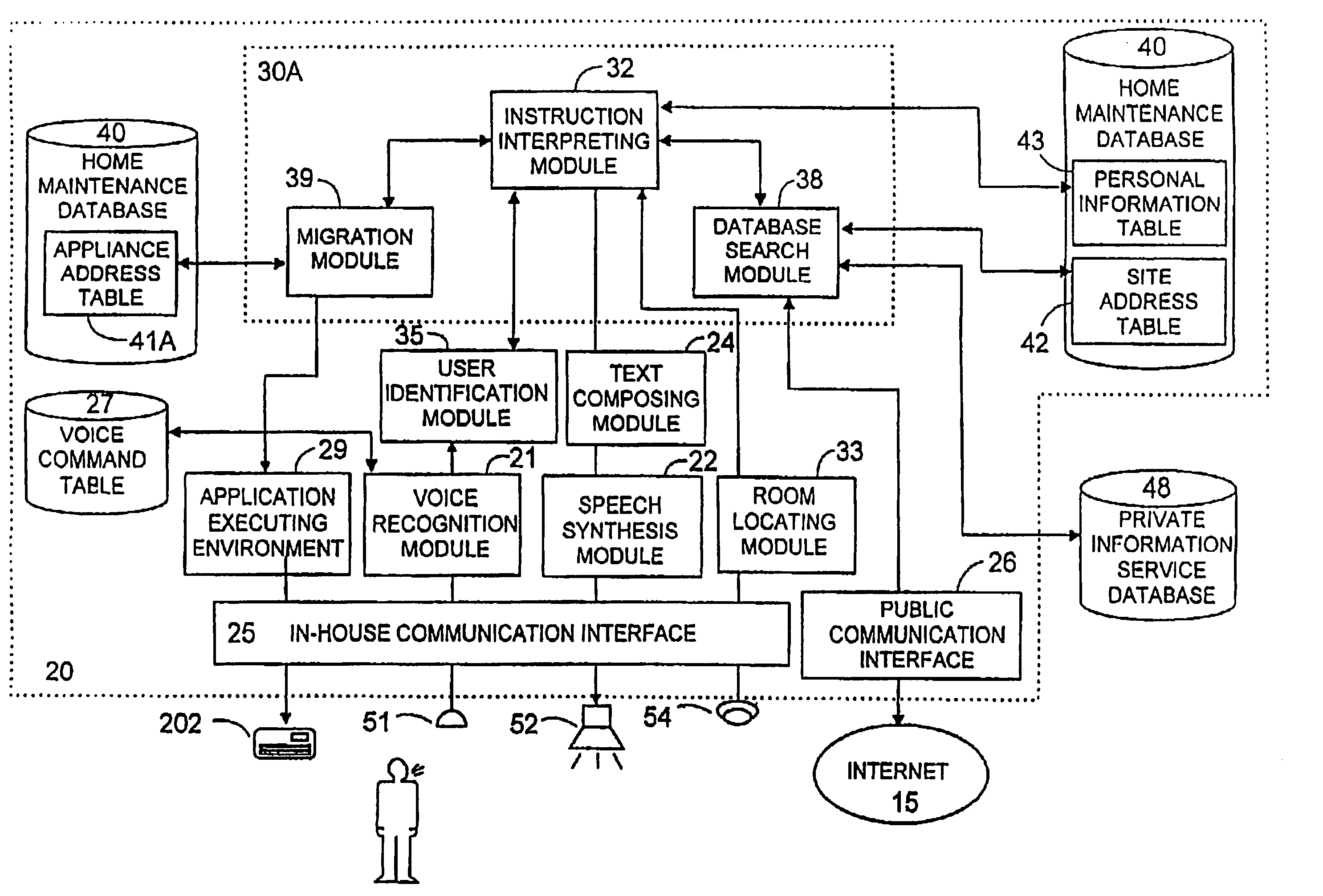

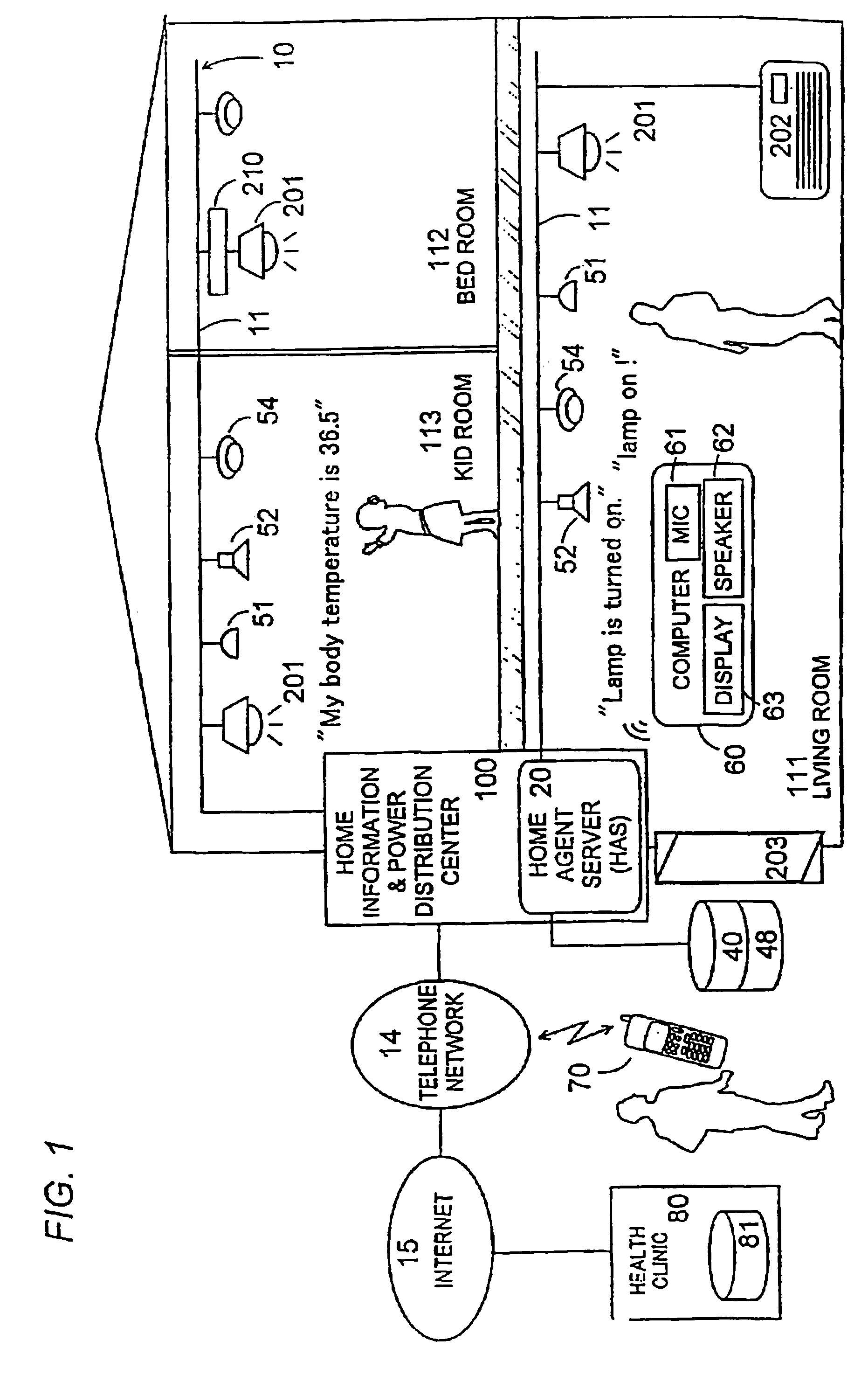

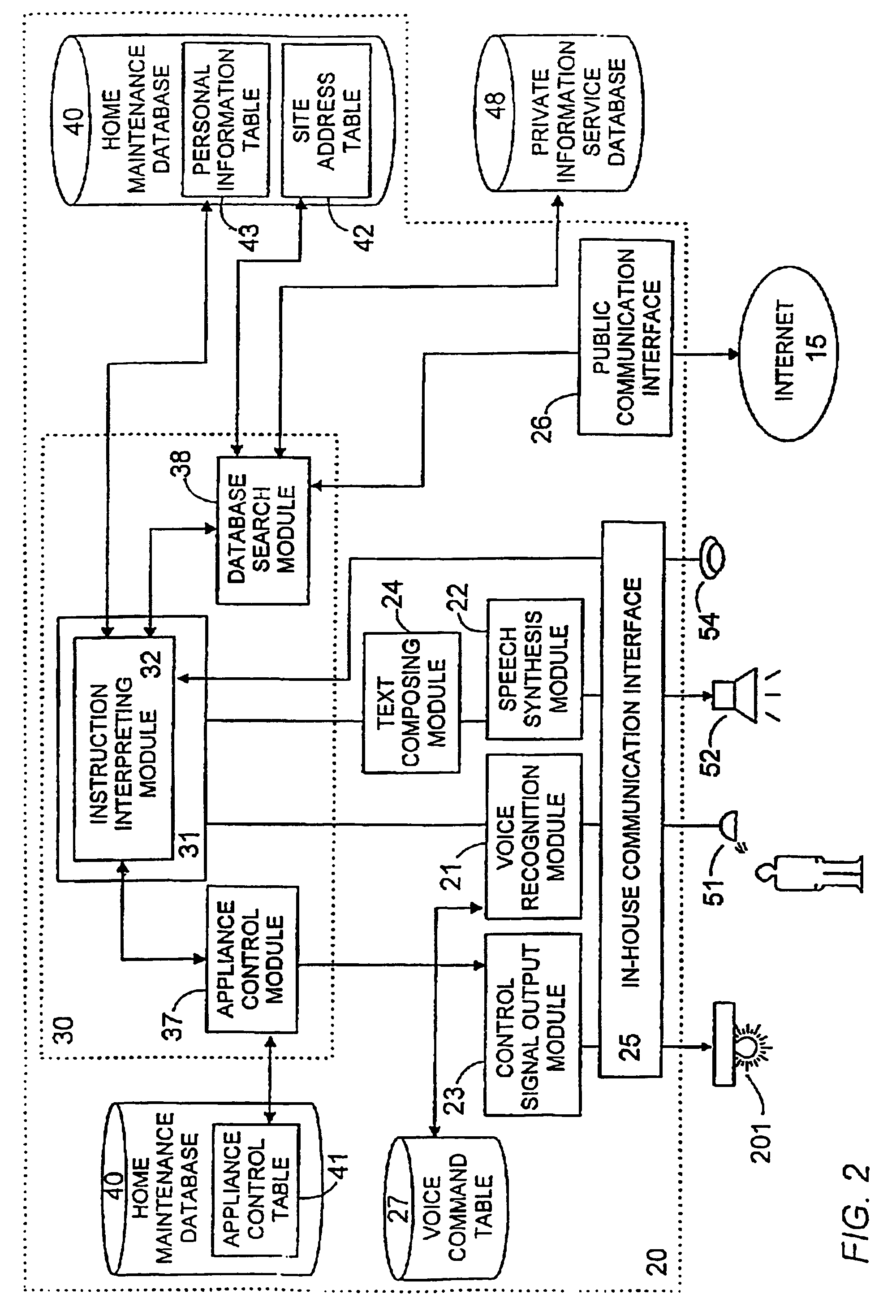

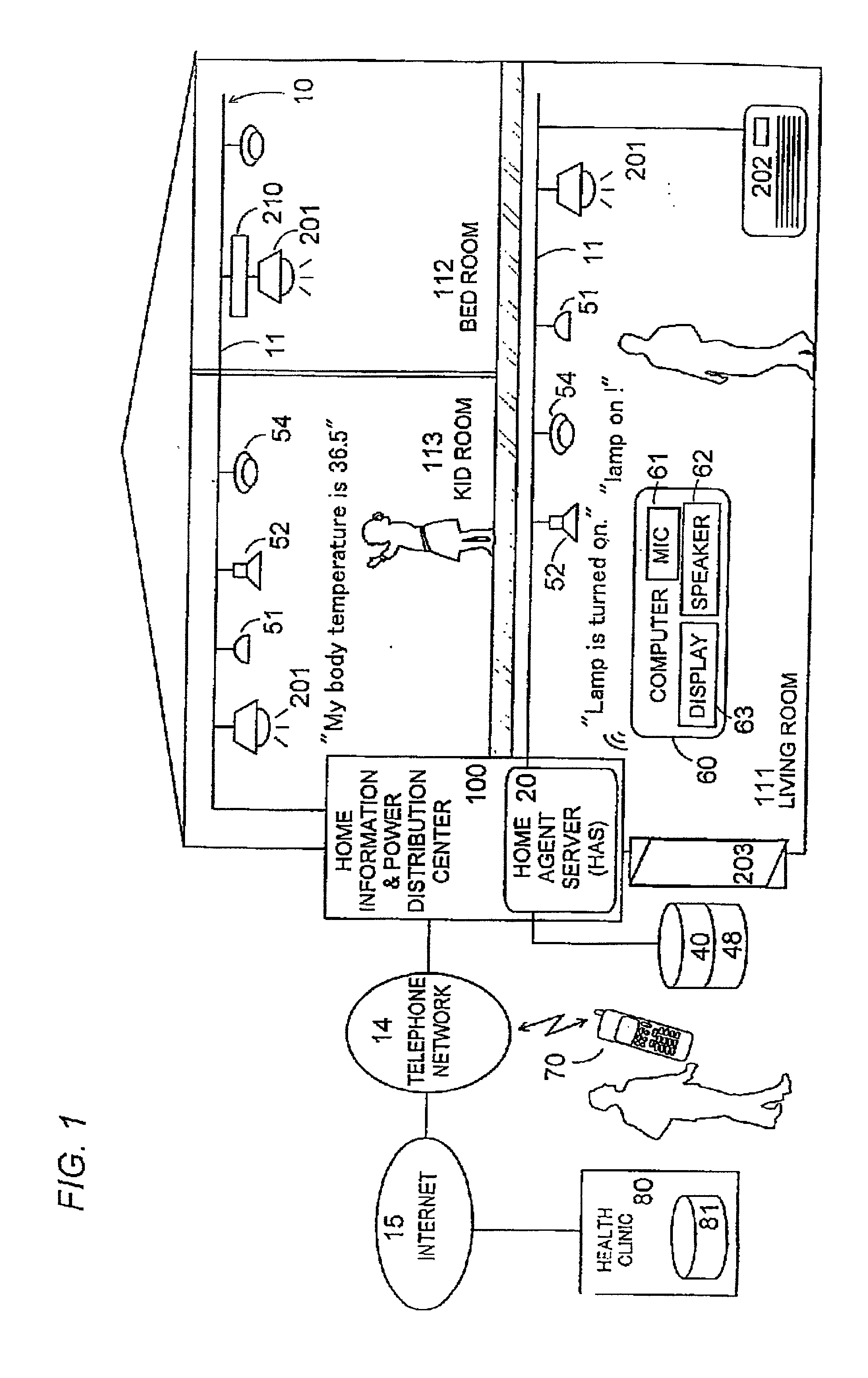

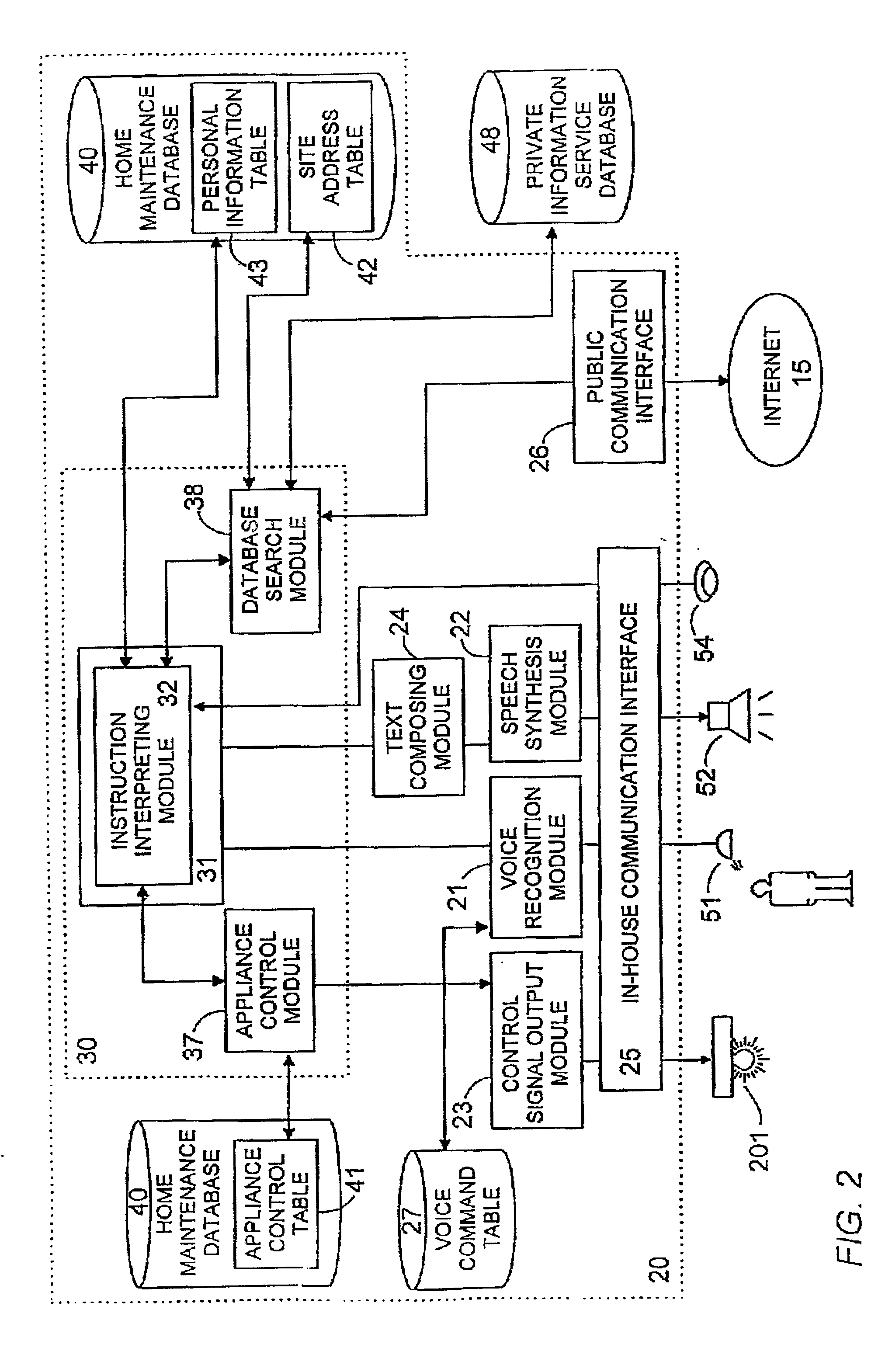

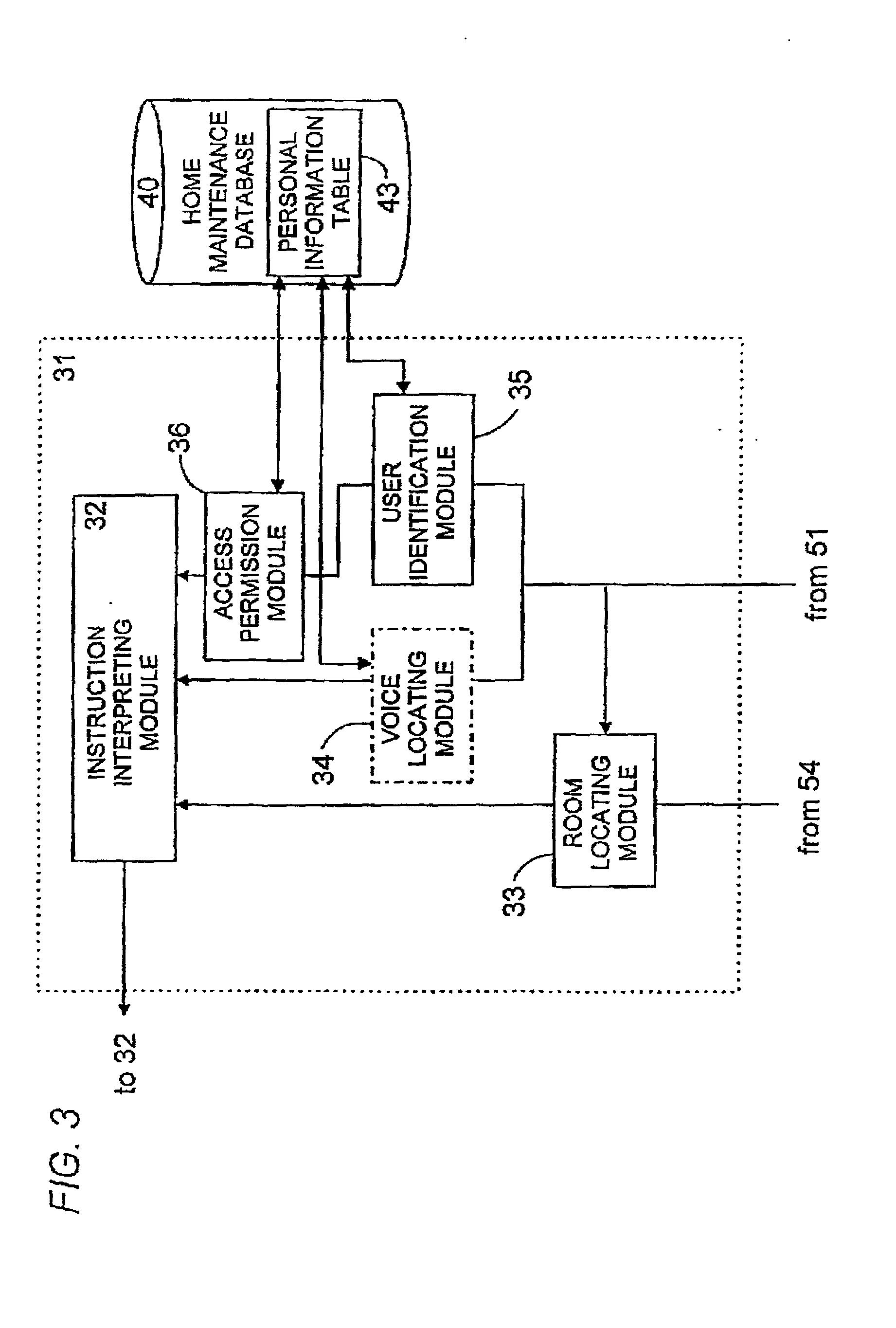

Voice control system for operating home electrical appliances

InactiveUS6988070B2Easy to operateEasy to manageTelemetry/telecontrol selection arrangementsData processing applicationsControl systemControl manner

A voice control system for managing home electrical appliances includes a home agent server (HAS) connected to the home electrical appliances, a microphone and a speaker linked to the agent server through an in-house network. An transaction processing (TP) program runs on HAS and interprets the user's voice request to find a destined appliance and a manner of control the same, and performs the requested control to the destined appliance. The result is notified to the user by means of a voice message.

Owner:MATSUSHITA ELECTRIC WORKS LTD

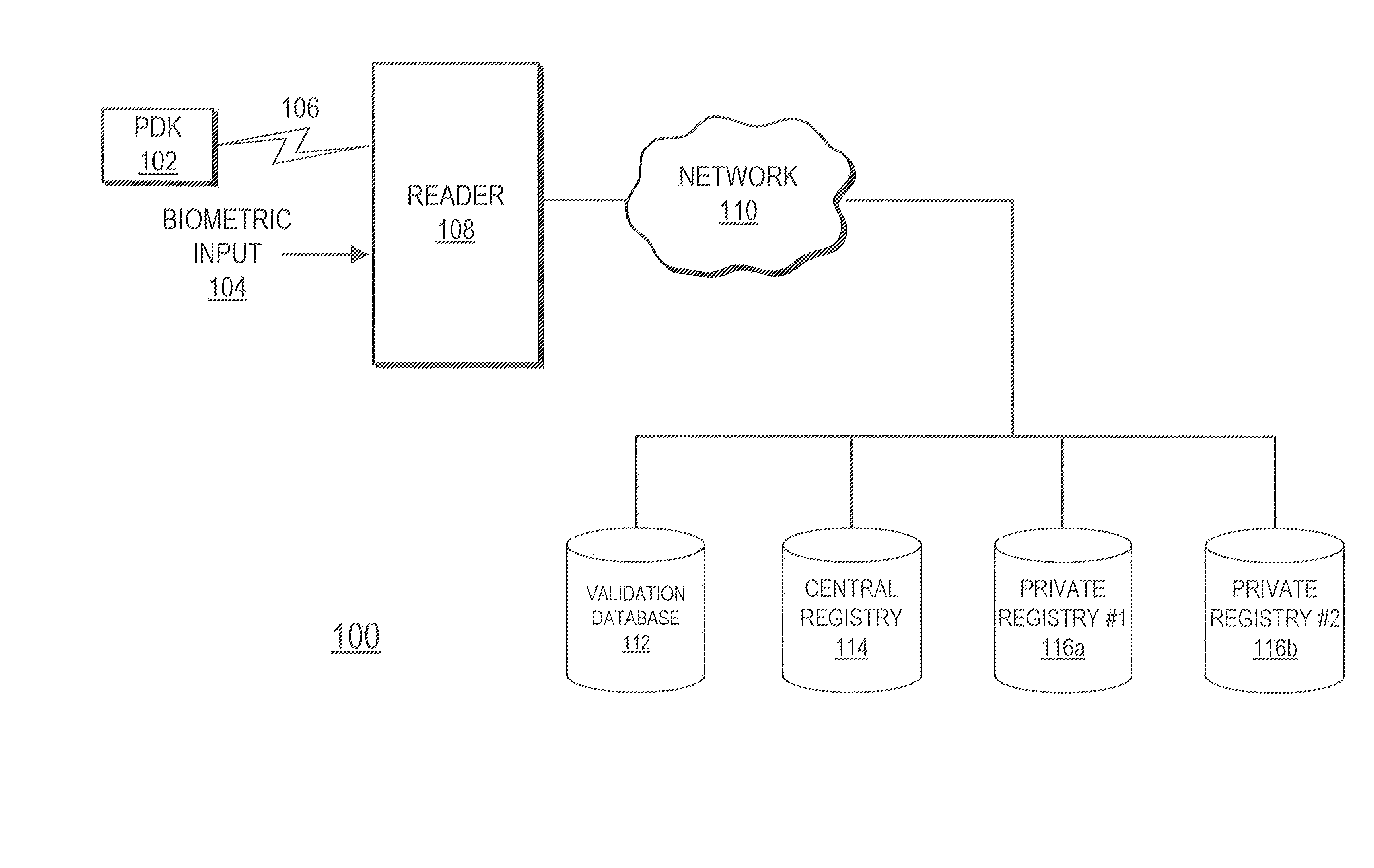

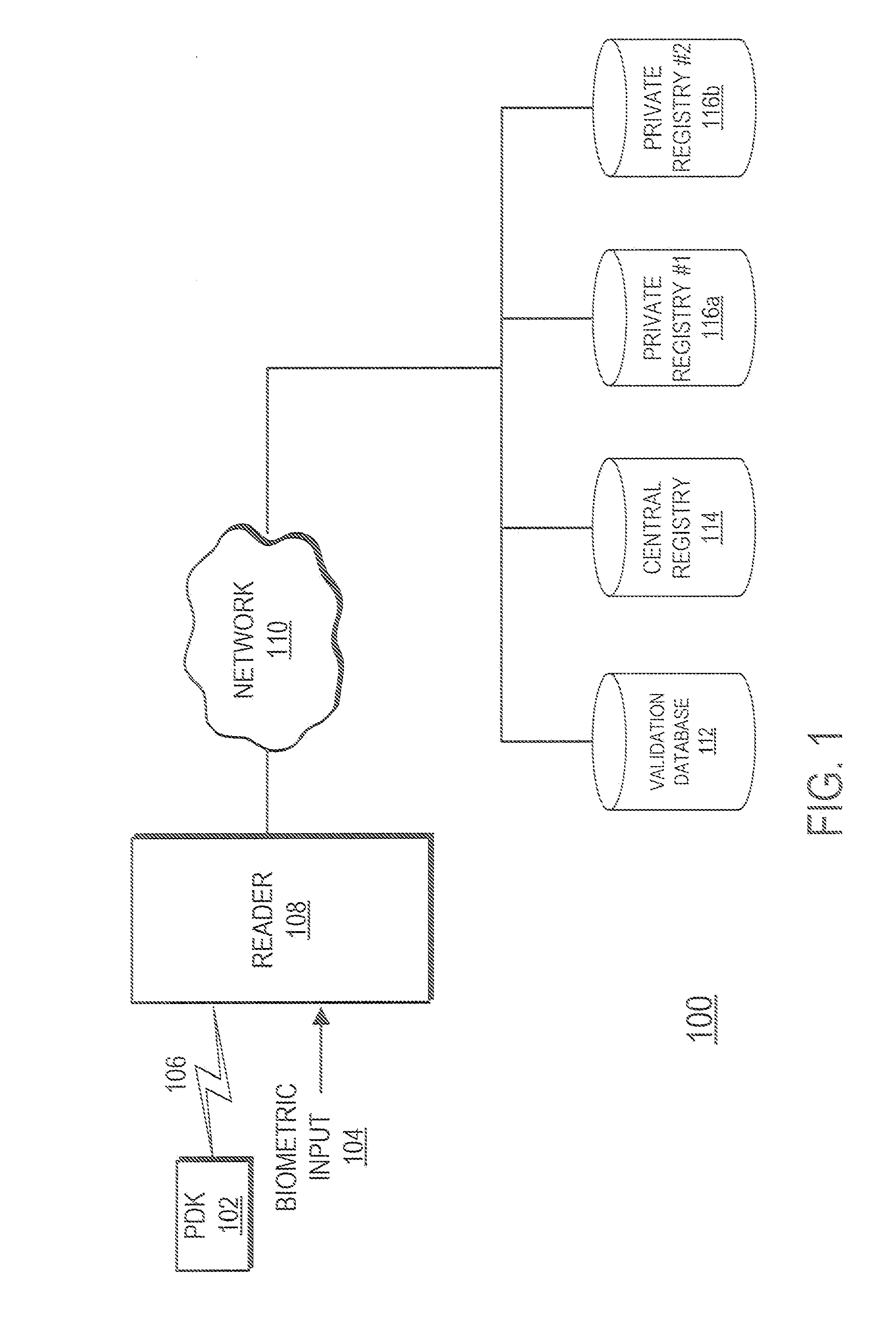

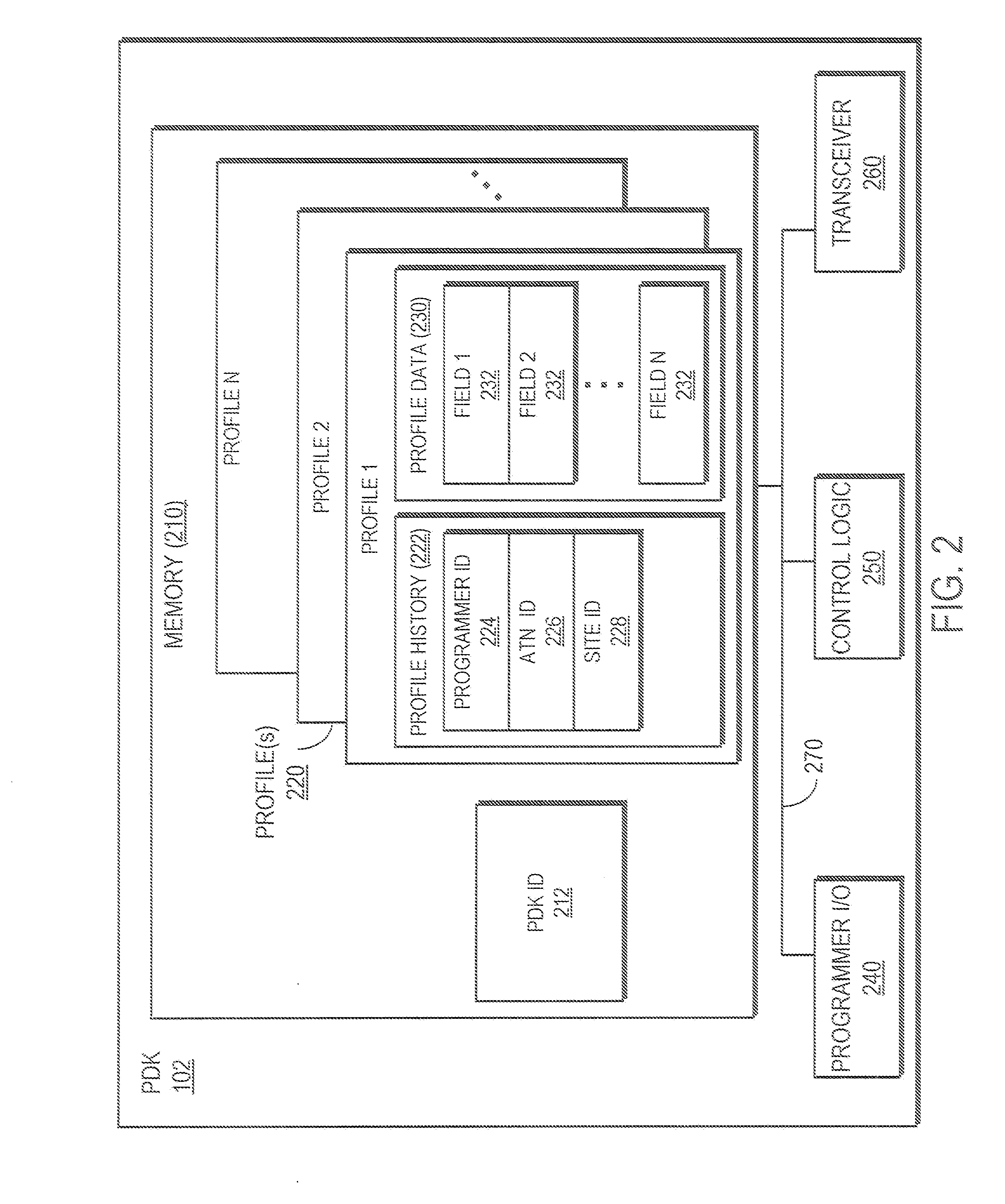

Single step transaction authentication using proximity and biometric input

ActiveUS20070245158A1Efficient and secure and highly reliable authenticationAcutation objectsUser identity/authority verificationWireless transmissionTransaction processing

A system and method provide efficient, secure and highly reliable authentication for transaction processing and / or access control applications in which only biometric input is required from the user. A Personal Digital Key stores a biometric profile that comprises a representation of physical or behavioral characteristics that are uniquely associated with an individual that owns and carries the PDK. The PDK wirelessly transmits the biometric profile over a secure wireless transaction to a Reader for use in a biometric authentication process. The Reader compares the received biometric profile to a biometric input acquired at the point of transaction in order to determine if the transaction should be authorized.

Owner:PROXENSE

Voice control system for operating home electrical appliances

InactiveUS20010041982A1Avoid controlSafety managementData processing applicationsTelemetry/telecontrol selection arrangementsControl mannerControl system

A voice control system for managing home electrical appliances includes a home agent server (HAS) connected to the home electrical appliances, a microphone and a speaker linked to the agent server through an in-house network. An transaction processing (TP) program runs on HAS and interprets the user's voice request to find a destined appliance and a manner of control the same, and performs the requested control to the destined appliance. The result is notified to the user by means of a voice message.

Owner:MATSUSHITA ELECTRIC WORKS LTD

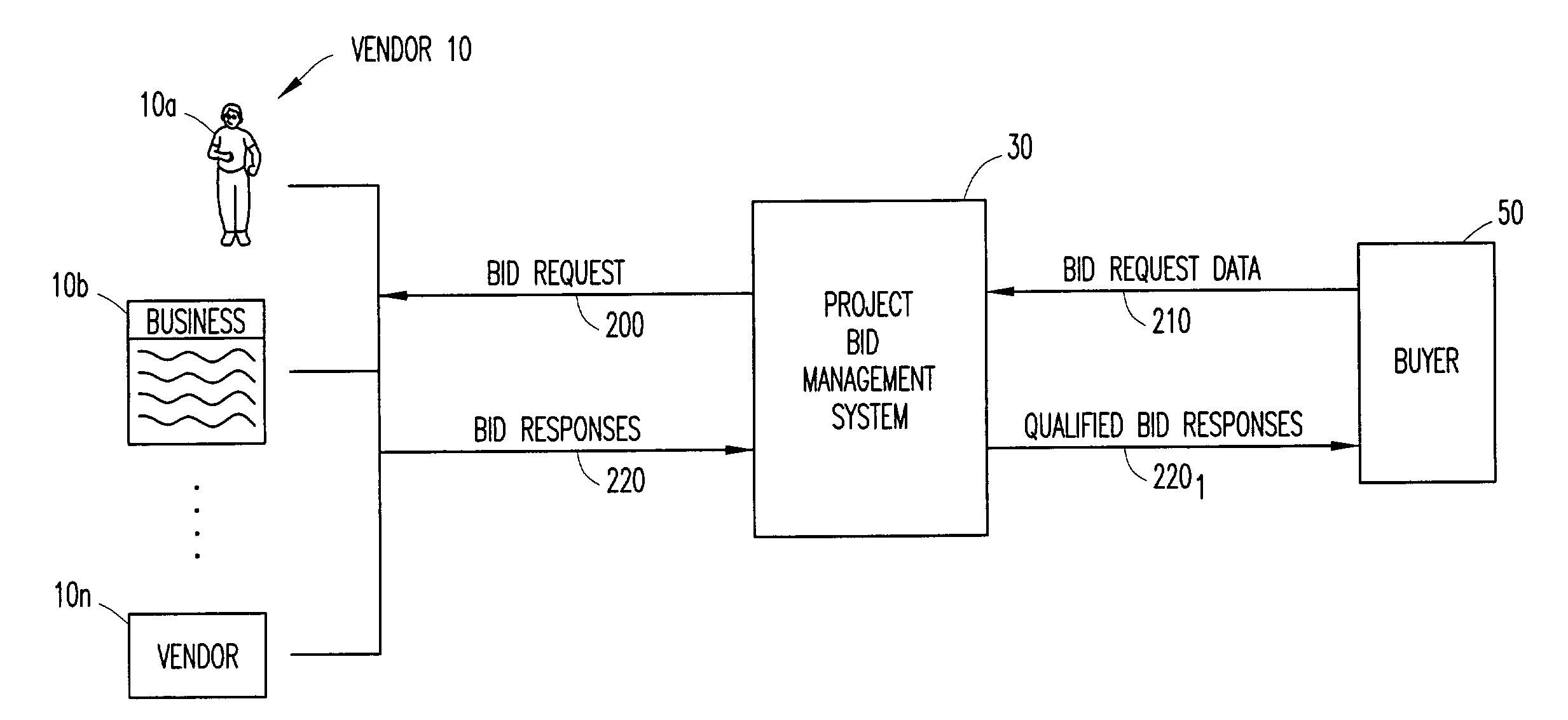

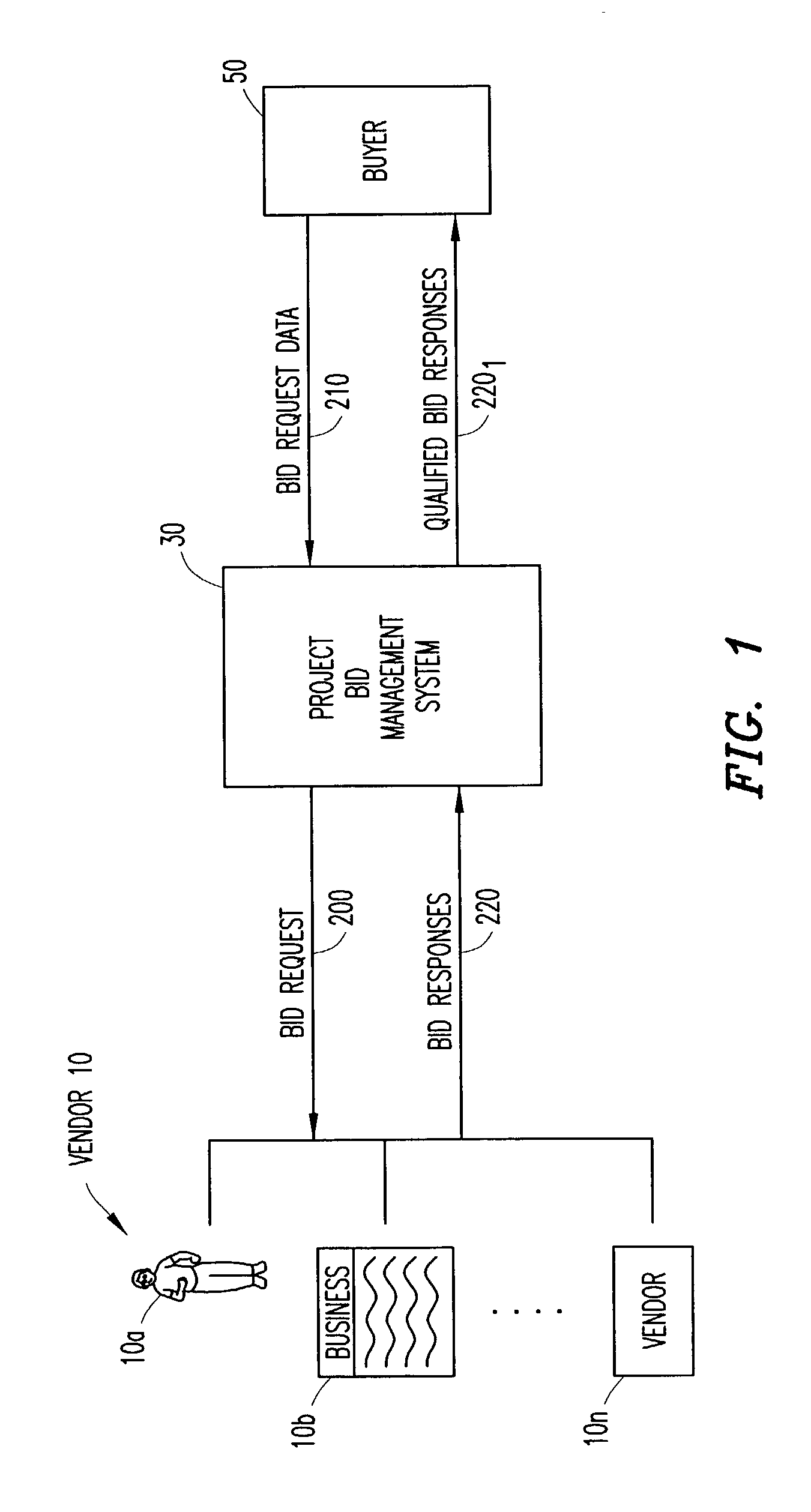

Computer system and method for facilitating and managing the project bid and requisition process

InactiveUS20030200168A1Efficient and effective analysis and comparisonProtects legal and business and financial interestFinanceDigital computer detailsComputerized systemProject tracking

A comprehensive, web-enabled computer system and method is provided for facilitating and managing all aspects of project work, while synchronizing communications, data and transaction processing across multiple user platforms. To implement the computer system and method, a bid item list is utilized to create configurable and scalable customized bid templates premised on the specific type of project work required. Bid requests are generated from the customized bid templates for solicitation of vendor bid responses to the selected bid items provided by the bid template. One or more bid items within the vendor bid responses can be selected for vendor grading purposes, and comparison of the vendor bid responses can be conducted using the graded bid item responses. In addition, project tracking parameters can be entered into the computer system for tracking the performance of the project.

Owner:IQNAVIGATOR

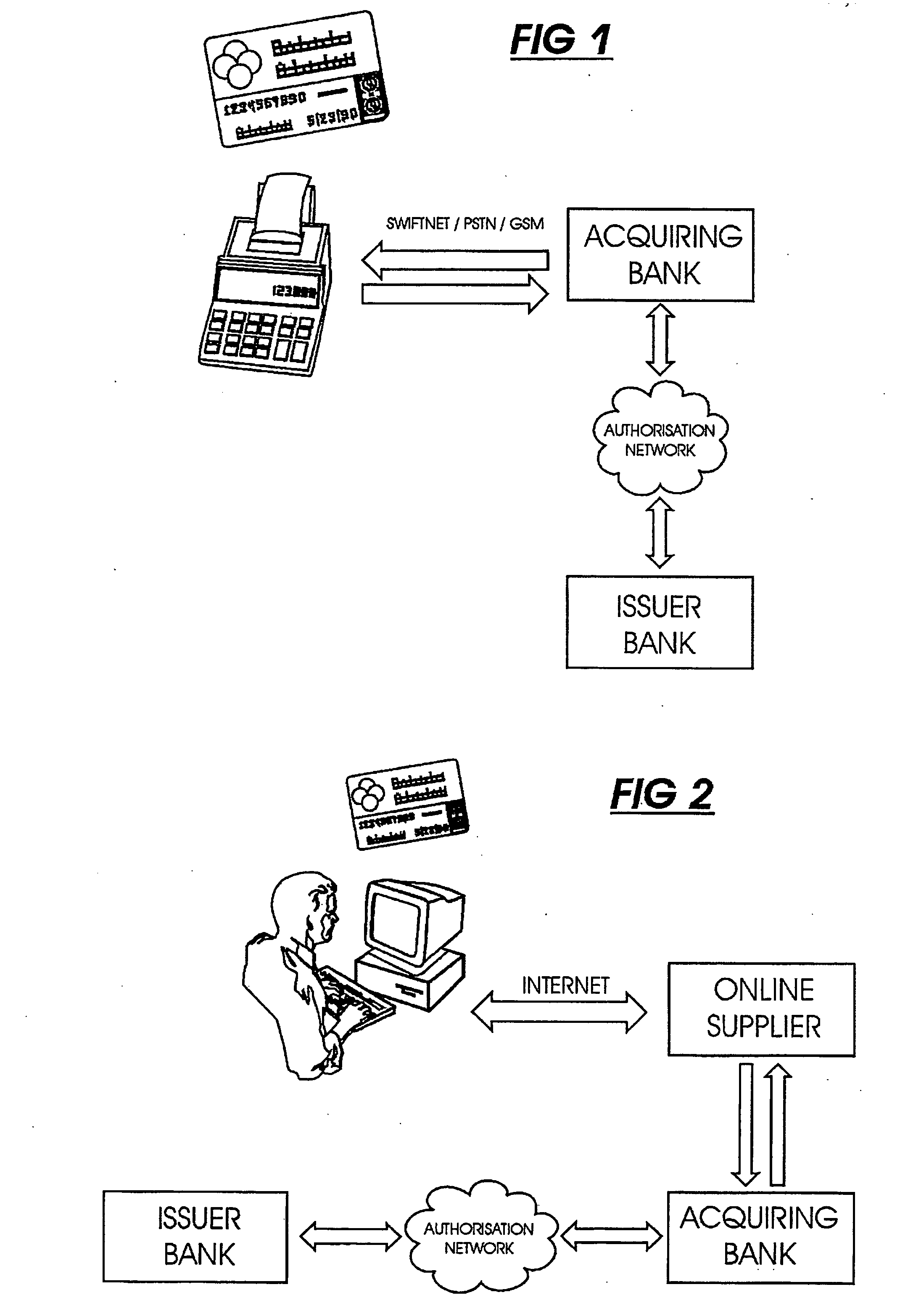

Transaction verification system

This invention uses separate, parallel communication channels to authorise and authenticate a transaction. A primary data channel (PSTN, radio or the like) is used to communicate between the merchant terminal and the bank, and a parallel data channel (a mobile phone network for instance) is used for the authentication process. In the example, the transaction is initiated (on a primary data channel), using a POS terminal as a transaction processing client. The transaction processing server and financial services provider fulfill their normal functions. At this point, the process loops into a transaction authorisation component using the parallel data channel, that requires authentication of the transaction initiator (the card holder). In the example, communications on the parallel data channel are by way of SMS. In the authorisation process, the card holder receives an SMS requesting authorisation of the transaction. If the card holder is not the transaction initiator, the card holder can cancel the transaction. If the transaction can be authorised, an authentication process is initiated in which the mobile phone is programmed to require the entry of a normally secret code (such as a personal identification number (PIN)) that serves to authenticate the card holder and to give final authorisation of the transaction.

Owner:NARAINSAMY SELVANATHAN

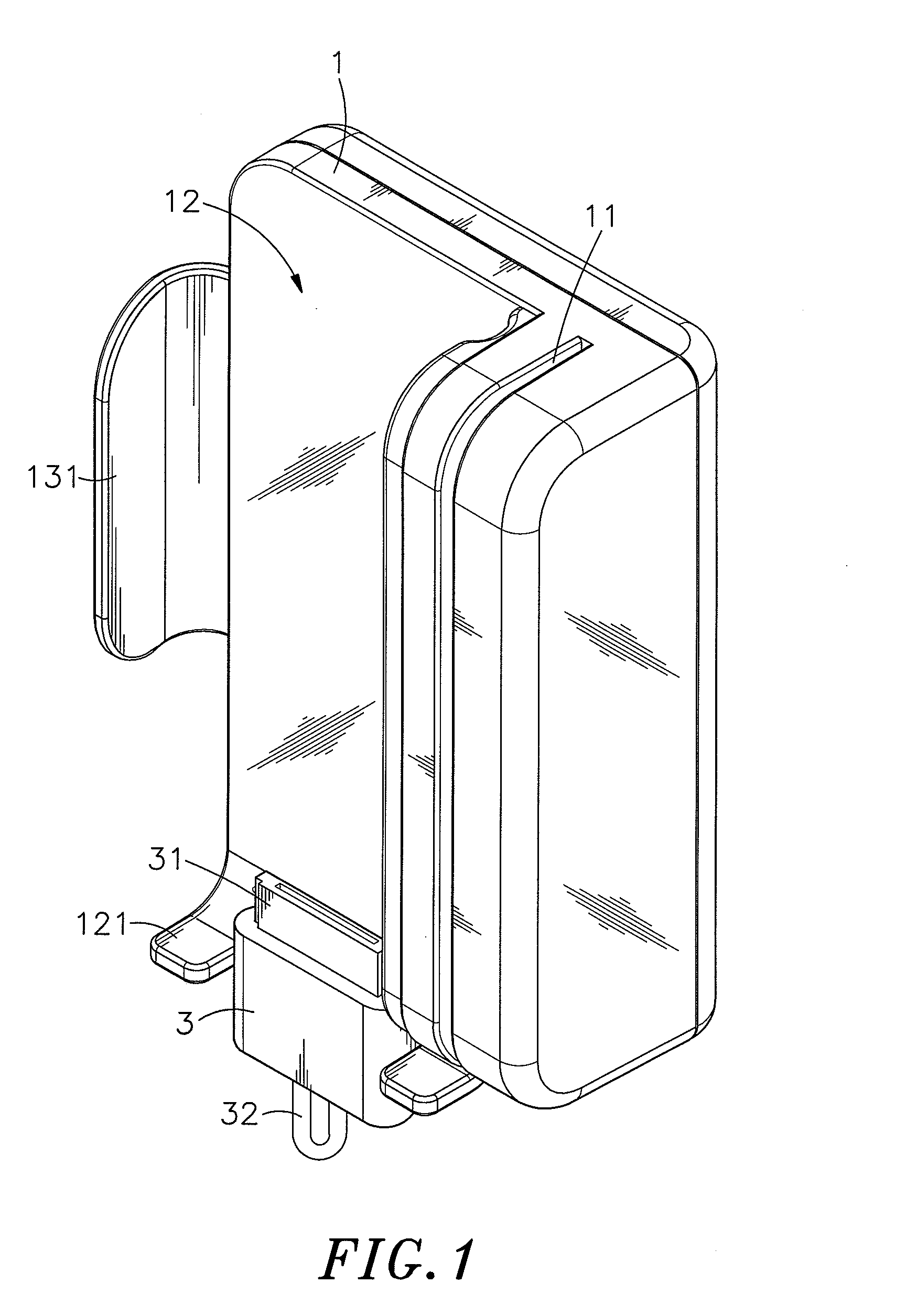

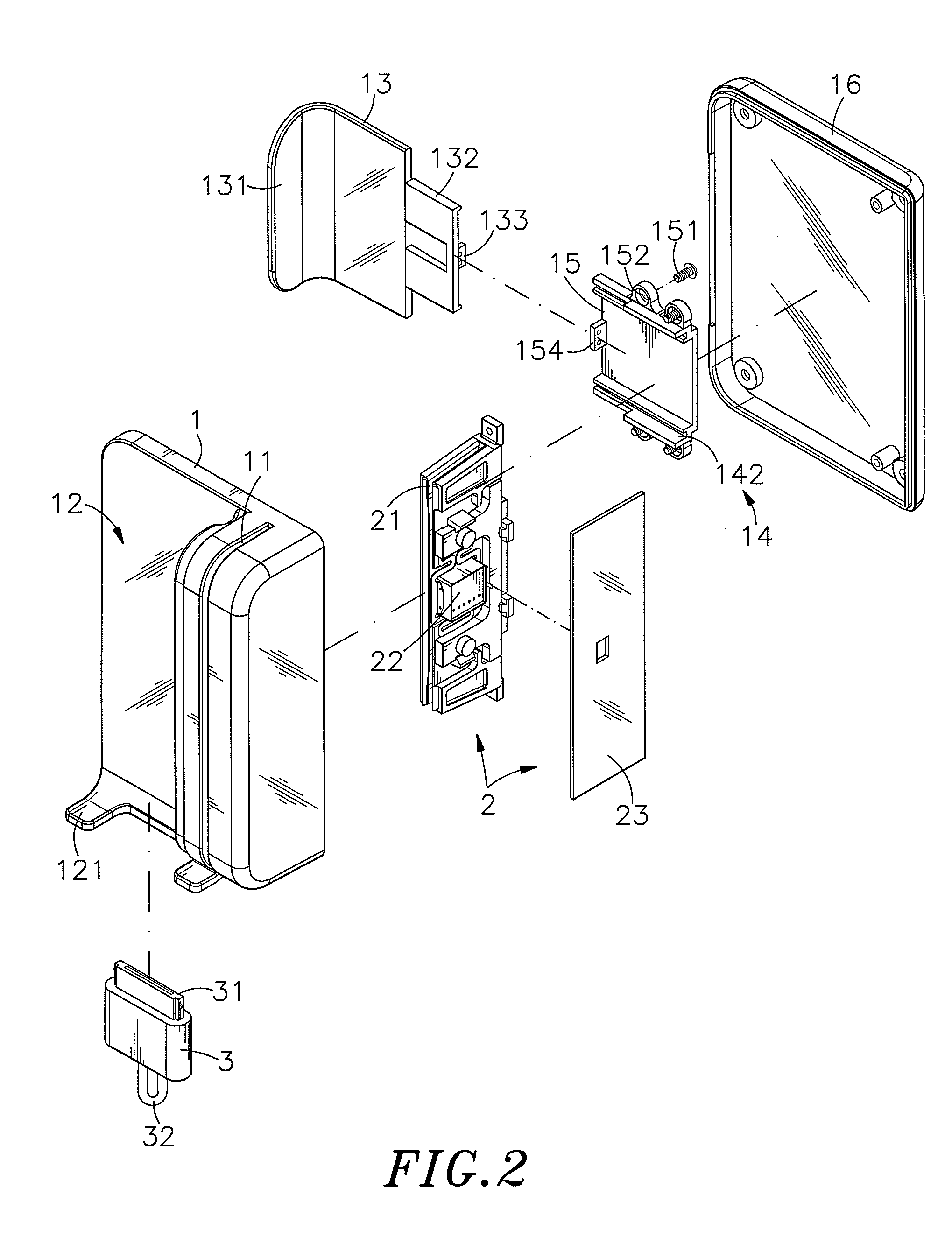

Handheld mobile credit card reader

A handheld mobile credit card reader includes a handy housing having a clamping space for holding a mobile electronic device, a card reader module mounted in a compartment in the housing and having a card slot set in alignment with a card-sliding slot at the front side of the housing for allowing a person to slide an electronic card therethrough and a card reader unit adapted for reading data from the electronic card being moved through the card slot, and a signal transmission device set in the front side of the housing for the connection of the attached mobile electronic device and electrically connected with the card reader unit for transmitting fetched data from the cad reader unit to the attached mobile electronic device for enabling the attached mobile electronic device to transmit the data to a remove remote credit card transaction processing center wirelessly to make a payment.

Owner:CHEN MIKE

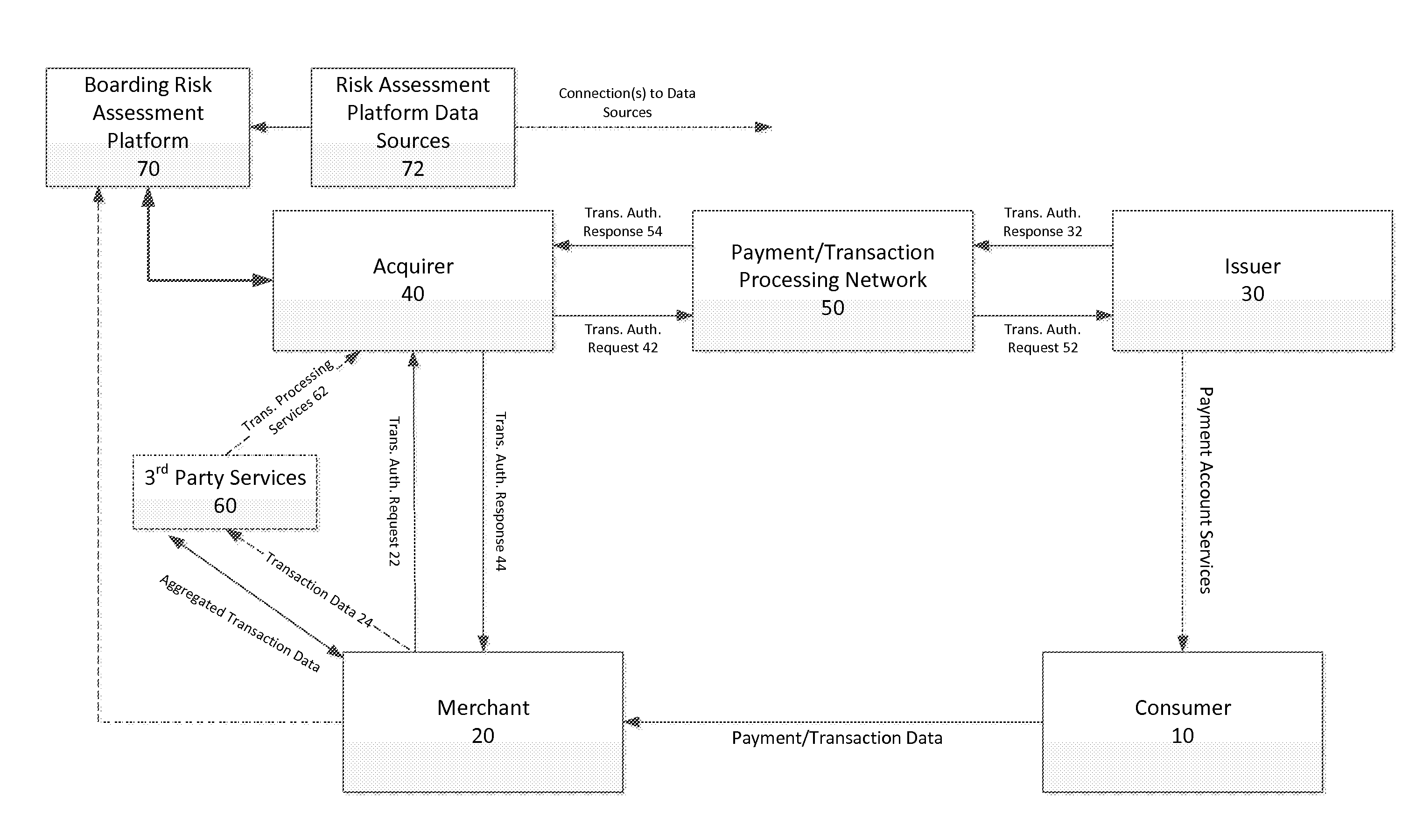

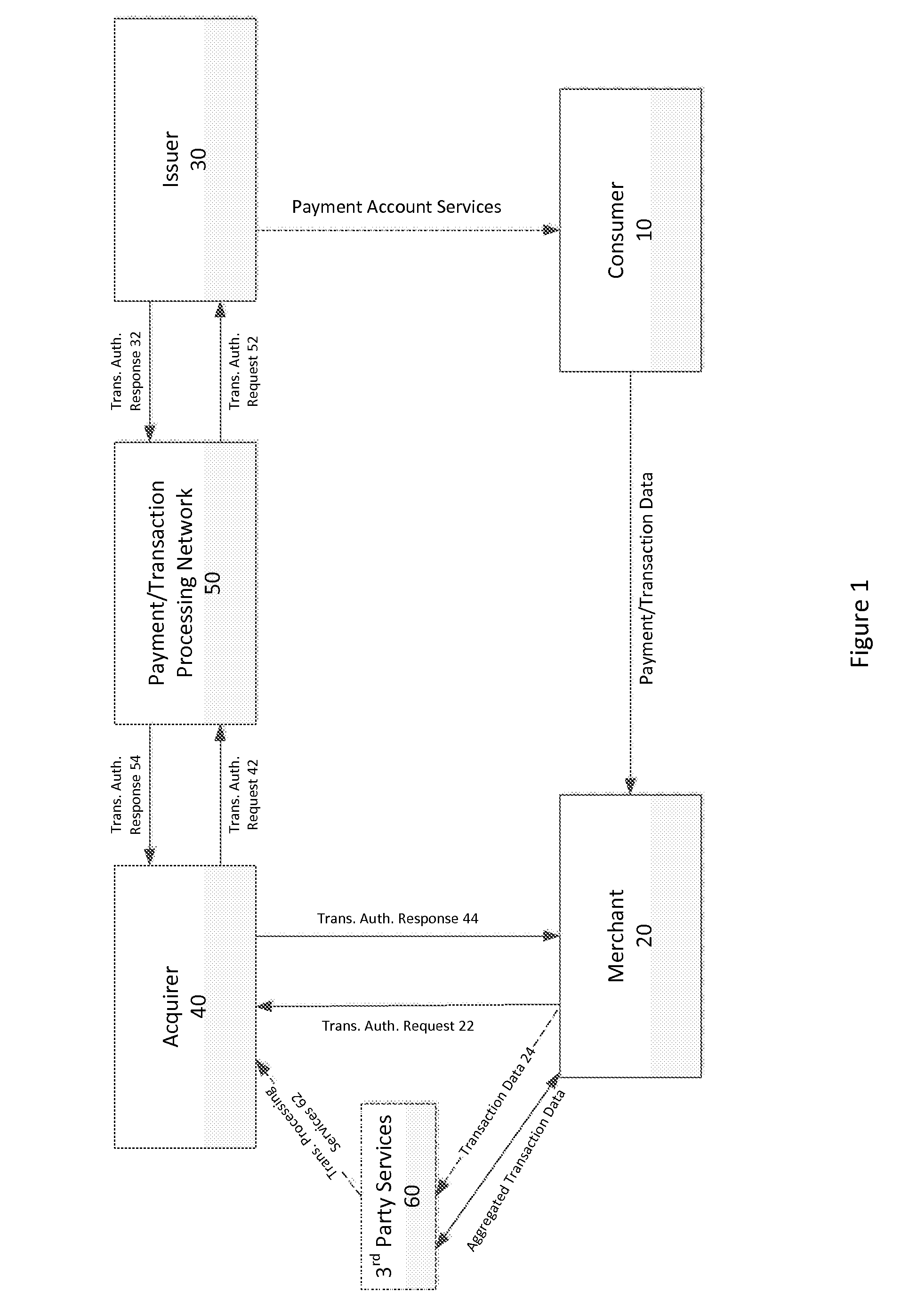

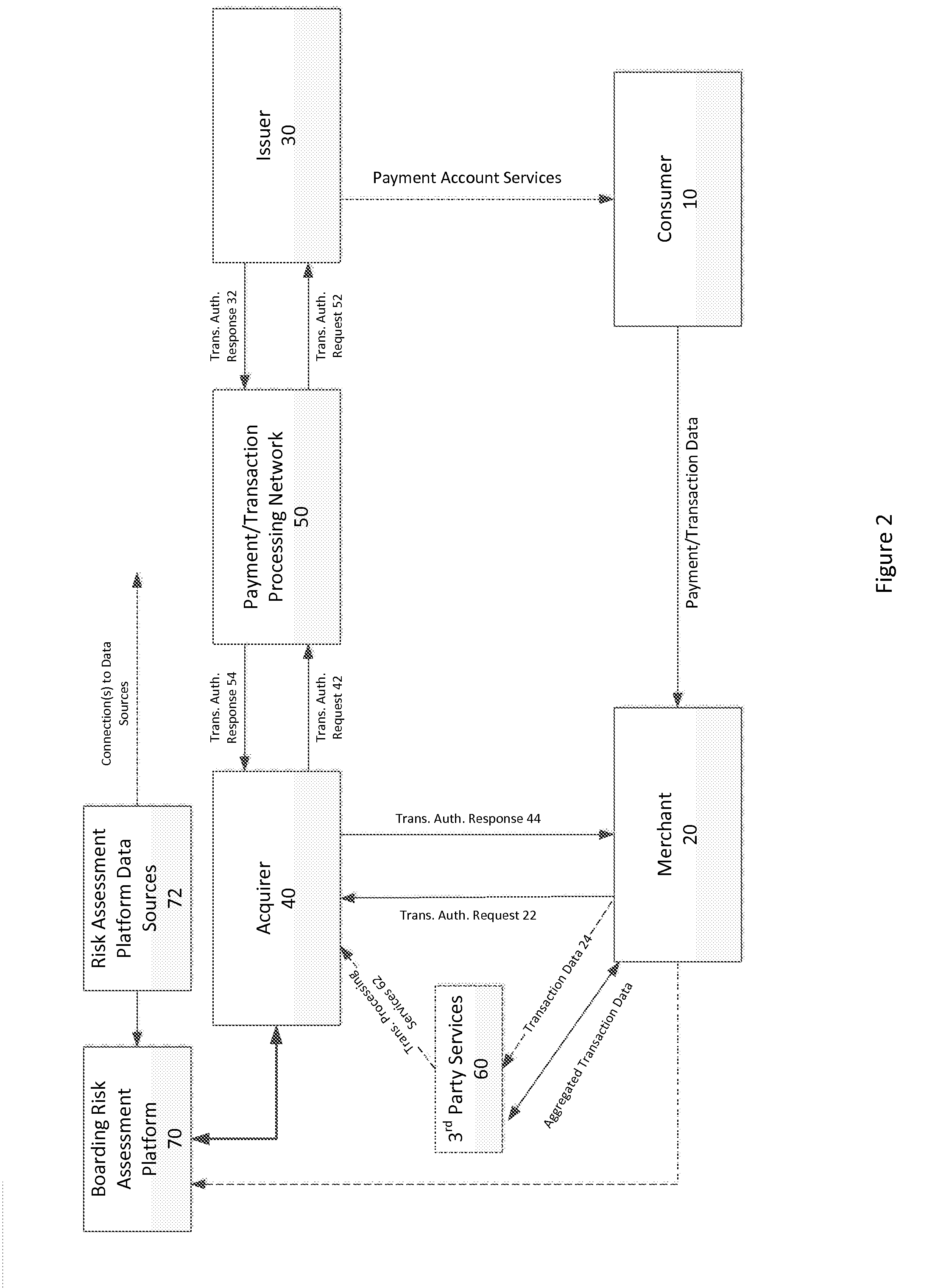

System and methods for global boarding of merchants

InactiveUS20150106260A1Limit scopeDetermination is accurate and reliableFinanceProtocol authorisationData sourceComputer science

Systems, apparatuses, and methods for determining if a Merchant should be provided transaction processing services by an Acquirer and / or continue to be provided such services by the Acquirer. In one embodiment, the inventive system and methods permit a more accurate and reliable determination of the risk to an Acquirer presented by a Merchant, based on a risk assessment engine and the described set of data sources.

Owner:G2 WEB SERVICES

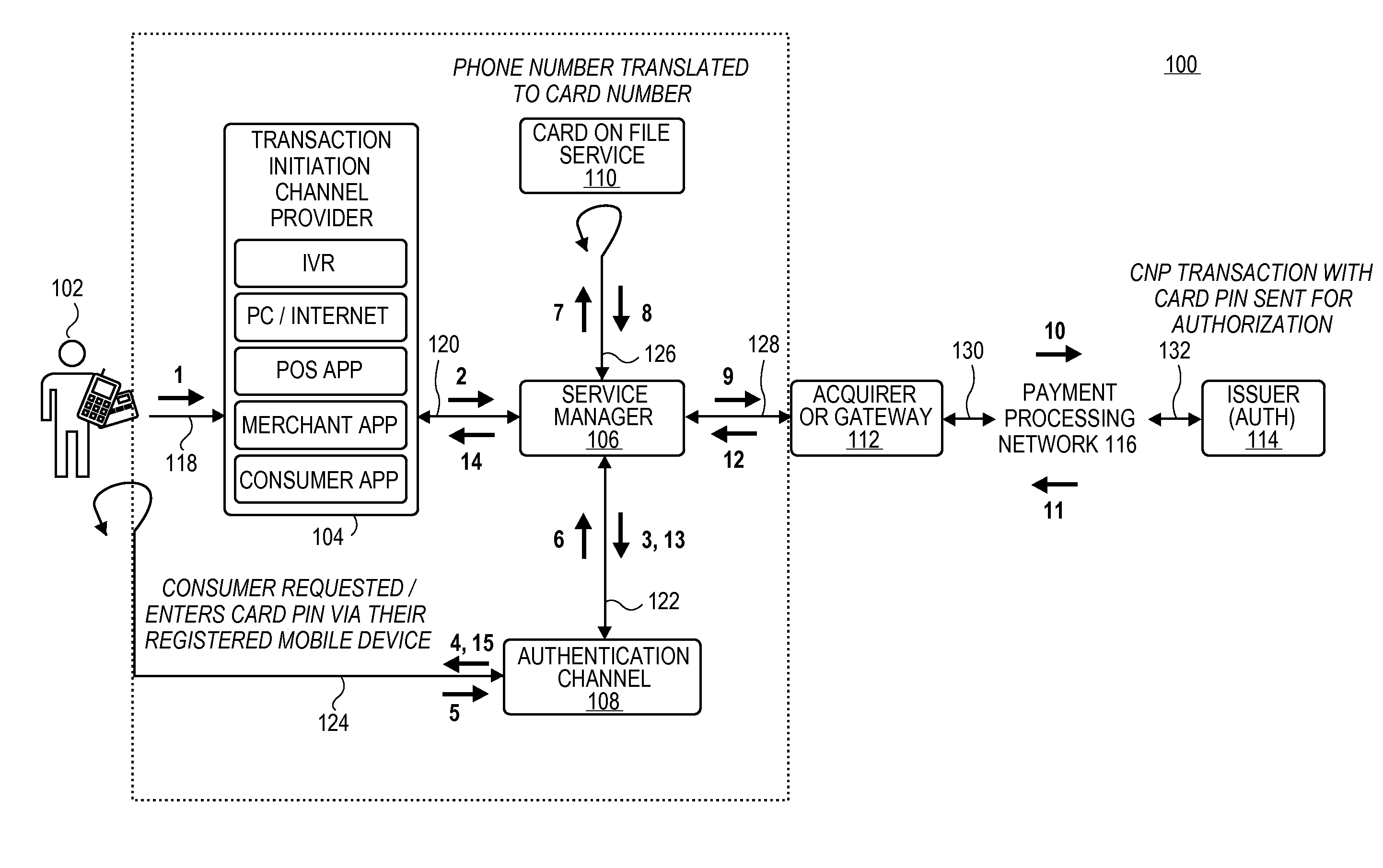

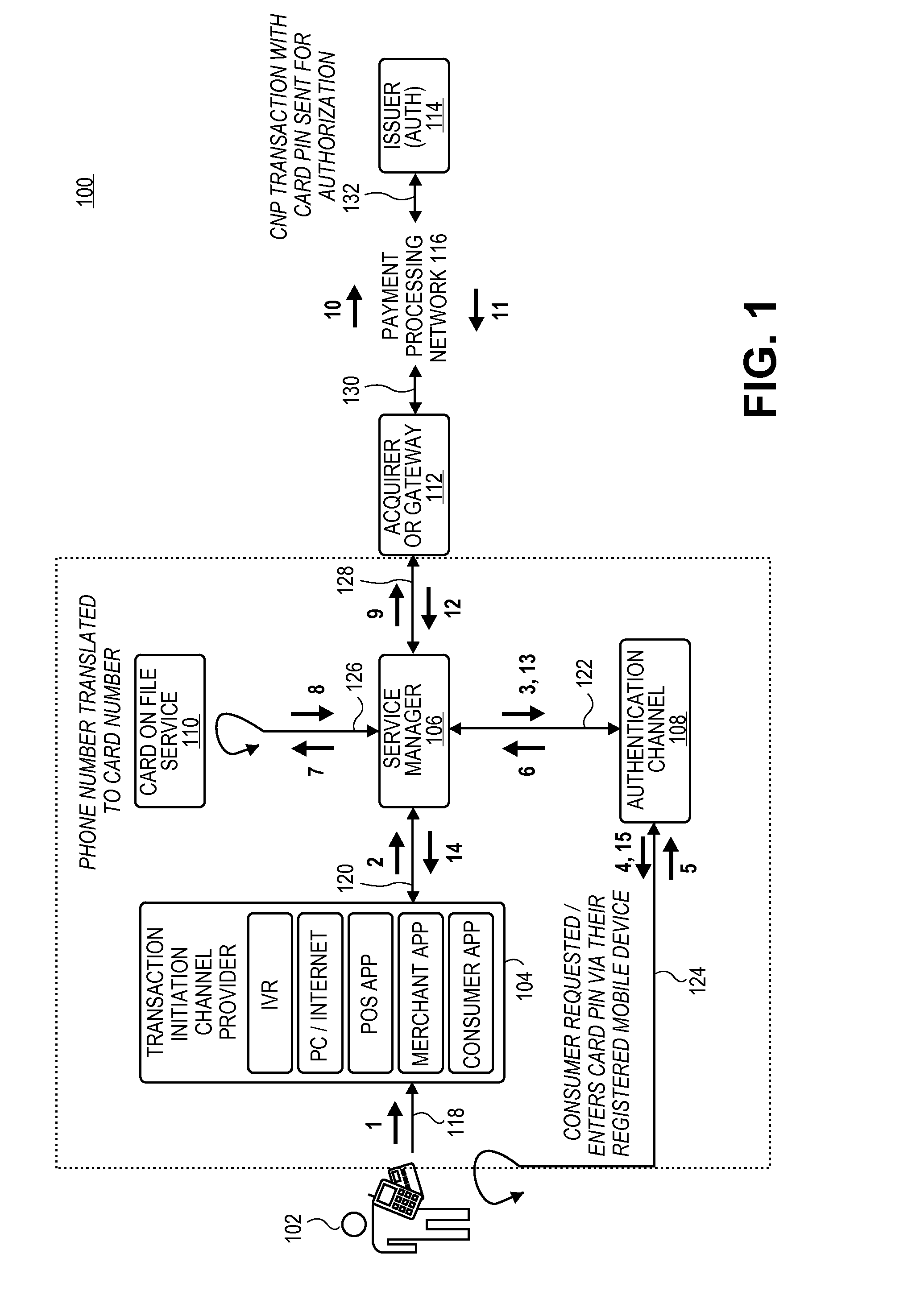

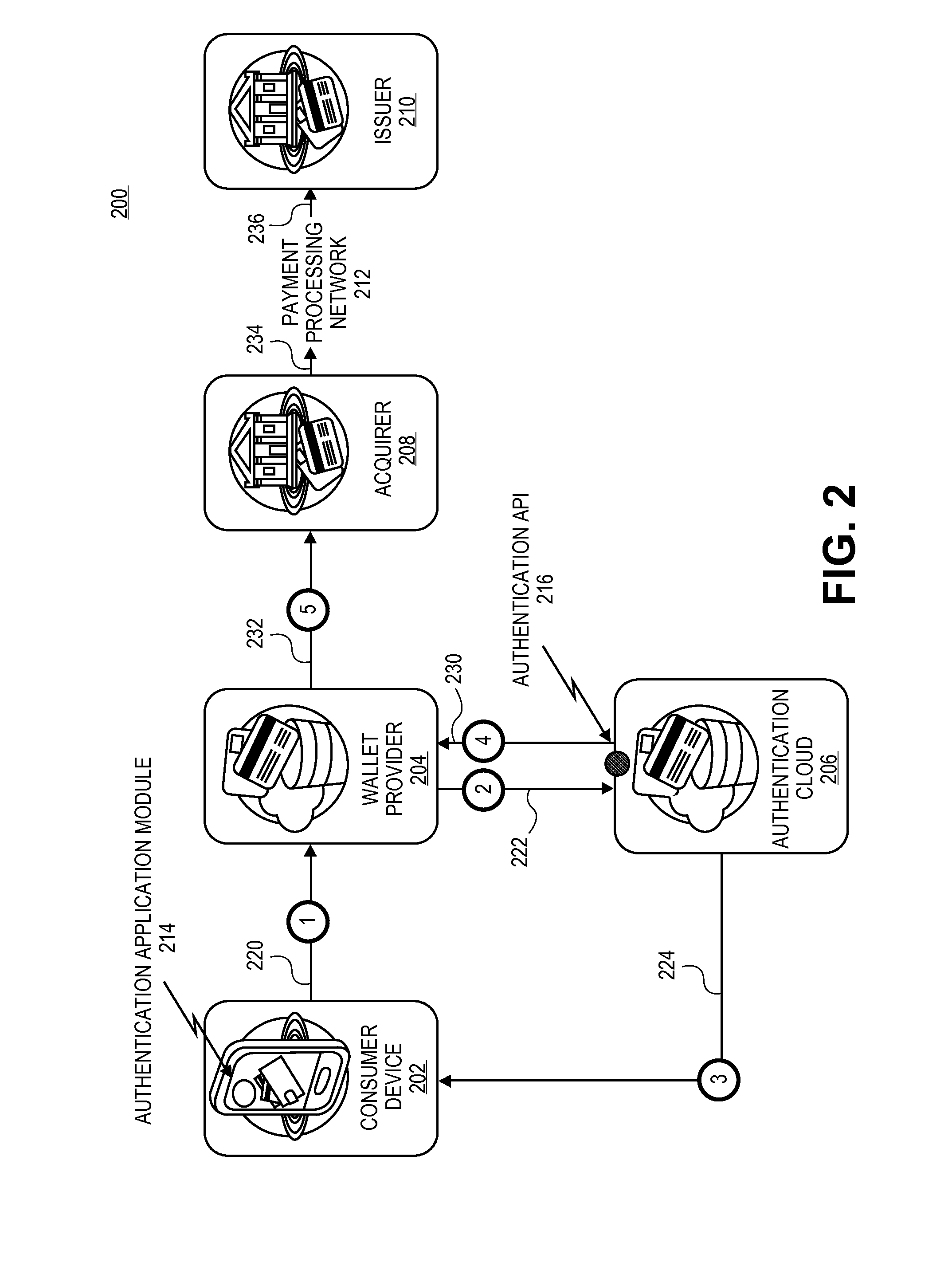

Authenticating Remote Transactions Using a Mobile Device

Embodiments of the invention can combine card not present transaction processing with PIN verification. A merchant or a consumer can initiate transactions using any suitable transaction initiation channel. One aspect of the invention helps facilitate payment card authentication across multiple wallet providers / merchants using an encrypted card PIN and a digital certificate. One aspect of the invention can incorporate the use of different transaction networks to perform authentication and authorization processing.

Owner:VISA INT SERVICE ASSOC

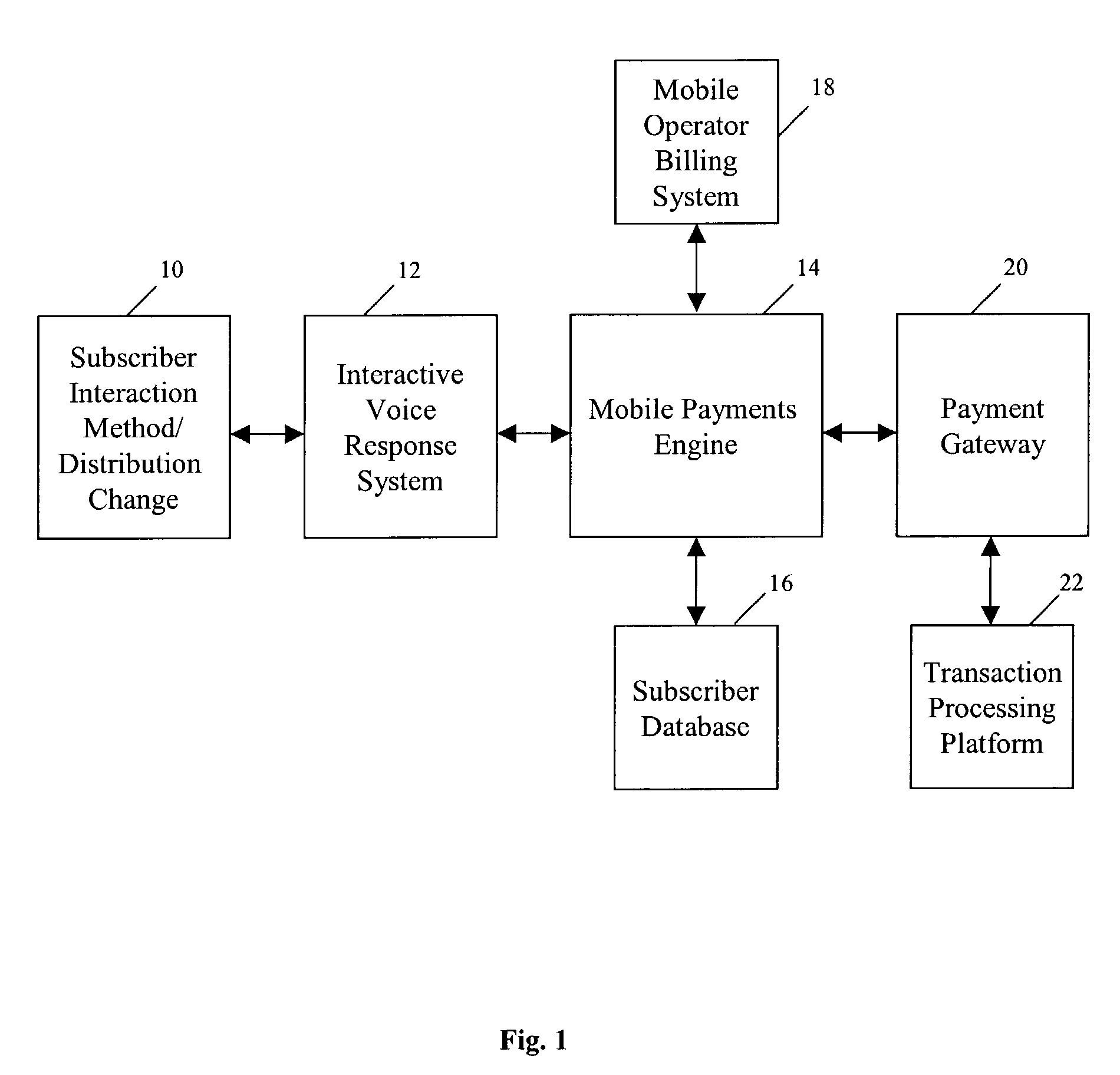

Method and system for data management in electronic payments transactions

ActiveUS7024174B2Reduces charge-backsEliminate the problemUnauthorised/fraudulent call preventionEavesdropping prevention circuitsPayment transactionThe Internet

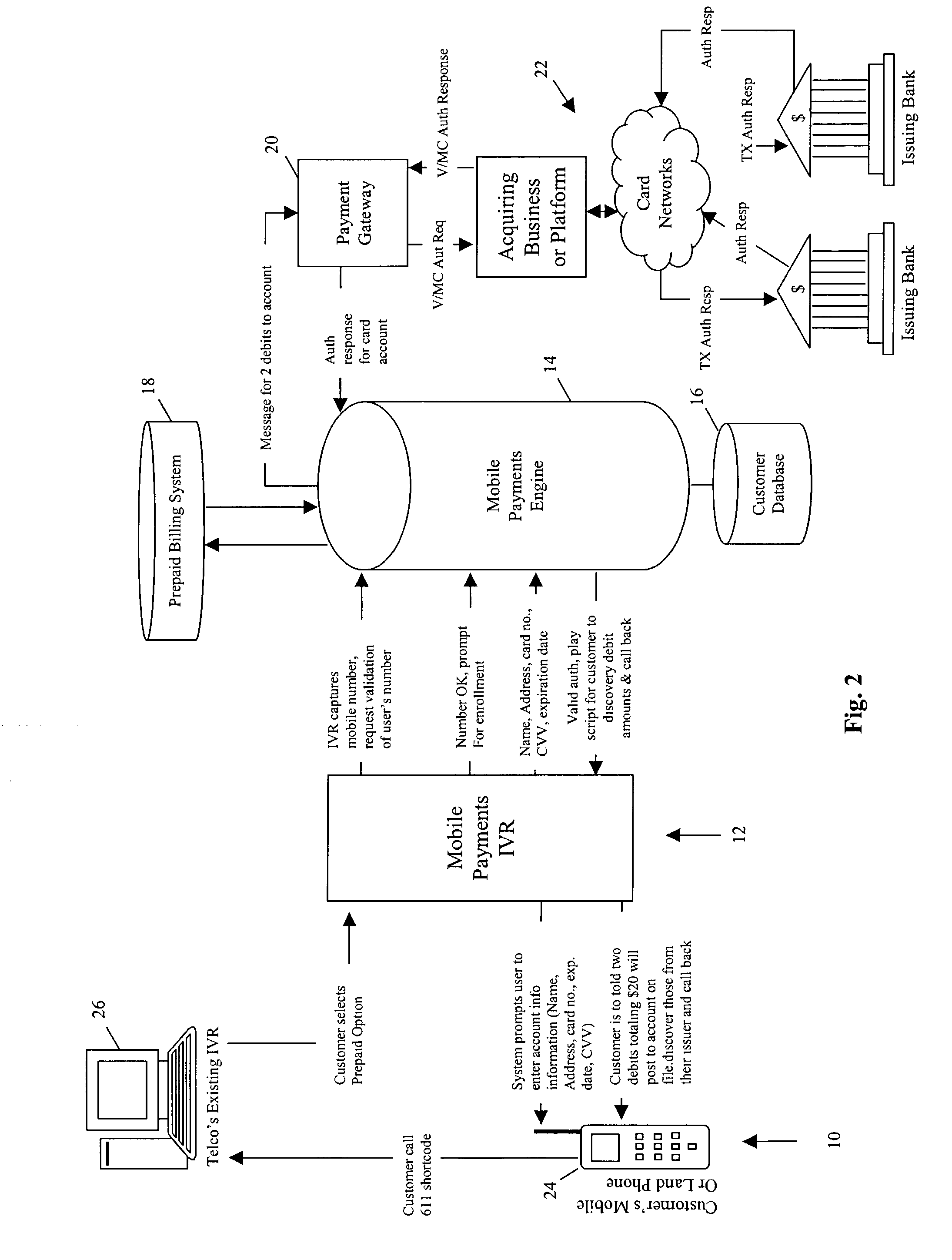

A method and system for prepaying wireless telecommunications charges utilizes computer hardware and software including, for example, a user's mobile phone, a mobile operator's interactive voice response unit, a mobile payments interactive voice response unit, SMS, test messaging, email, ATM, kiosk, the Internet, and / or WAP or the like, a mobile payments engine, a mobile operator's prepaid billing system, a subscriber database, a payment gateway, and a transaction processing platform. The mobile payments engine receives information identifying a user's wireless telecommunication device via the mobile payments interactive voice response unit, passes the information to the mobile operator's billing system with a request for validation of a mobile account for the user, and if validation is received, the mobile payments engine receives financial source account and user identity verification information from the user, assigns a mobile personal identification number for the user, and arranges a credit from the source account to the user's mobile account.

Owner:CITIBANK

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com