Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

1062 results about "Payment order" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Payment order, in international banking, is a directive to a bank from a bank account holder instructing the bank to make a payment or series of payments to a third party. Payment orders are post-contract instruments often used to pay fee agreements to agents and usually contain conditions for the payment to be met such as successful completion of contract requirements.

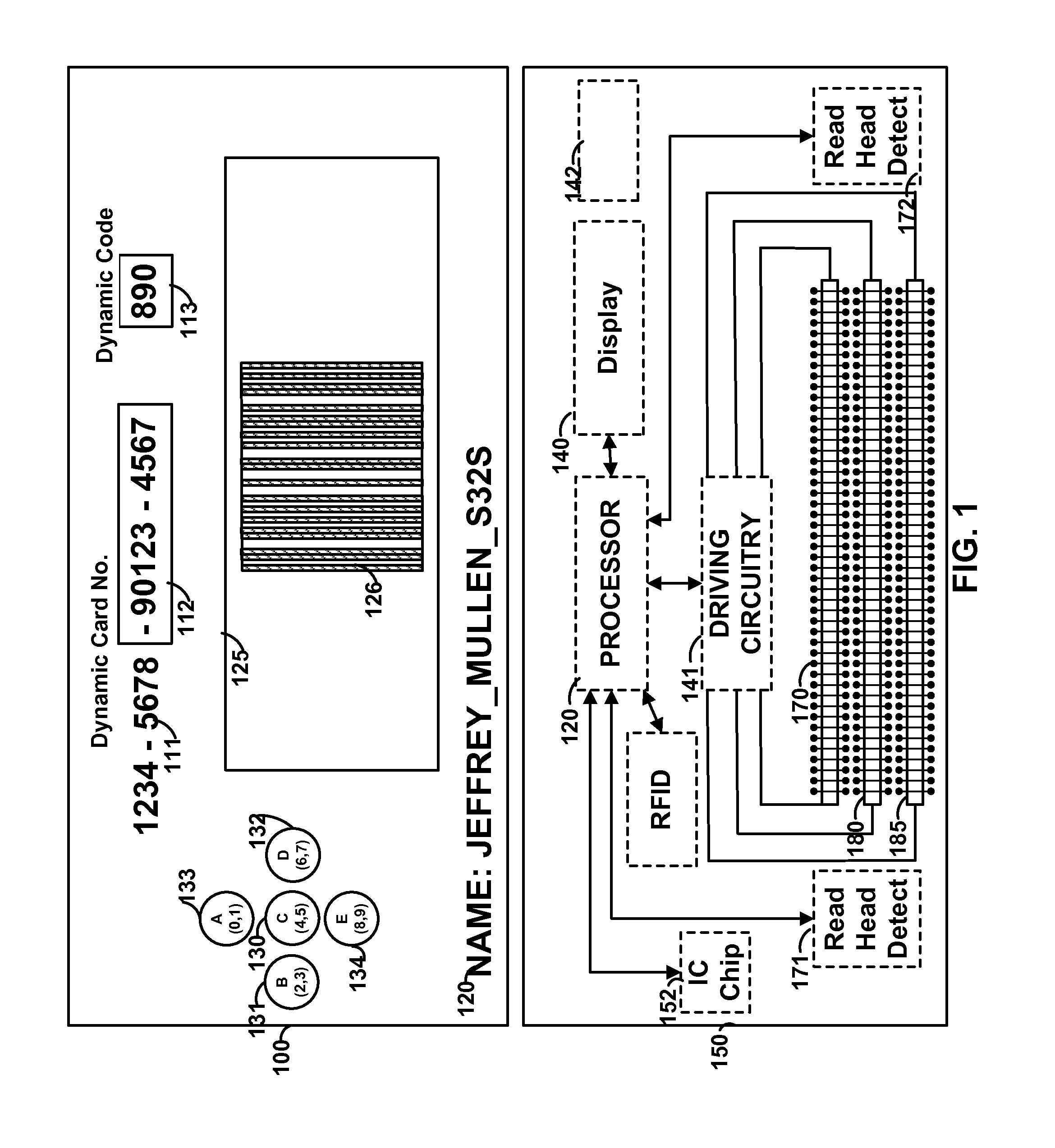

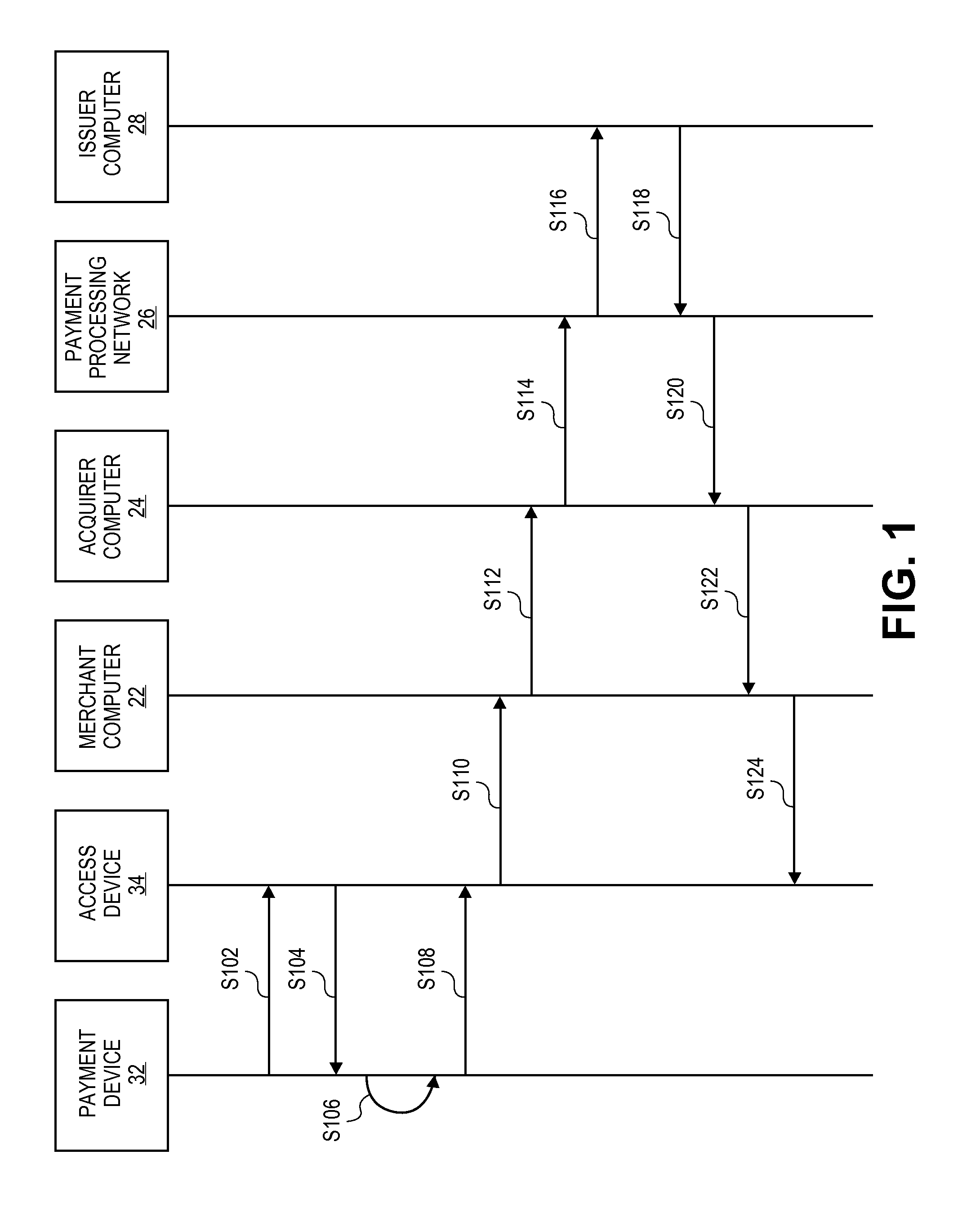

Financial transactions with dynamic card verification values

ActiveUS7584153B2Sufficient dataComputer security arrangementsPayment architectureUser needsDisplay device

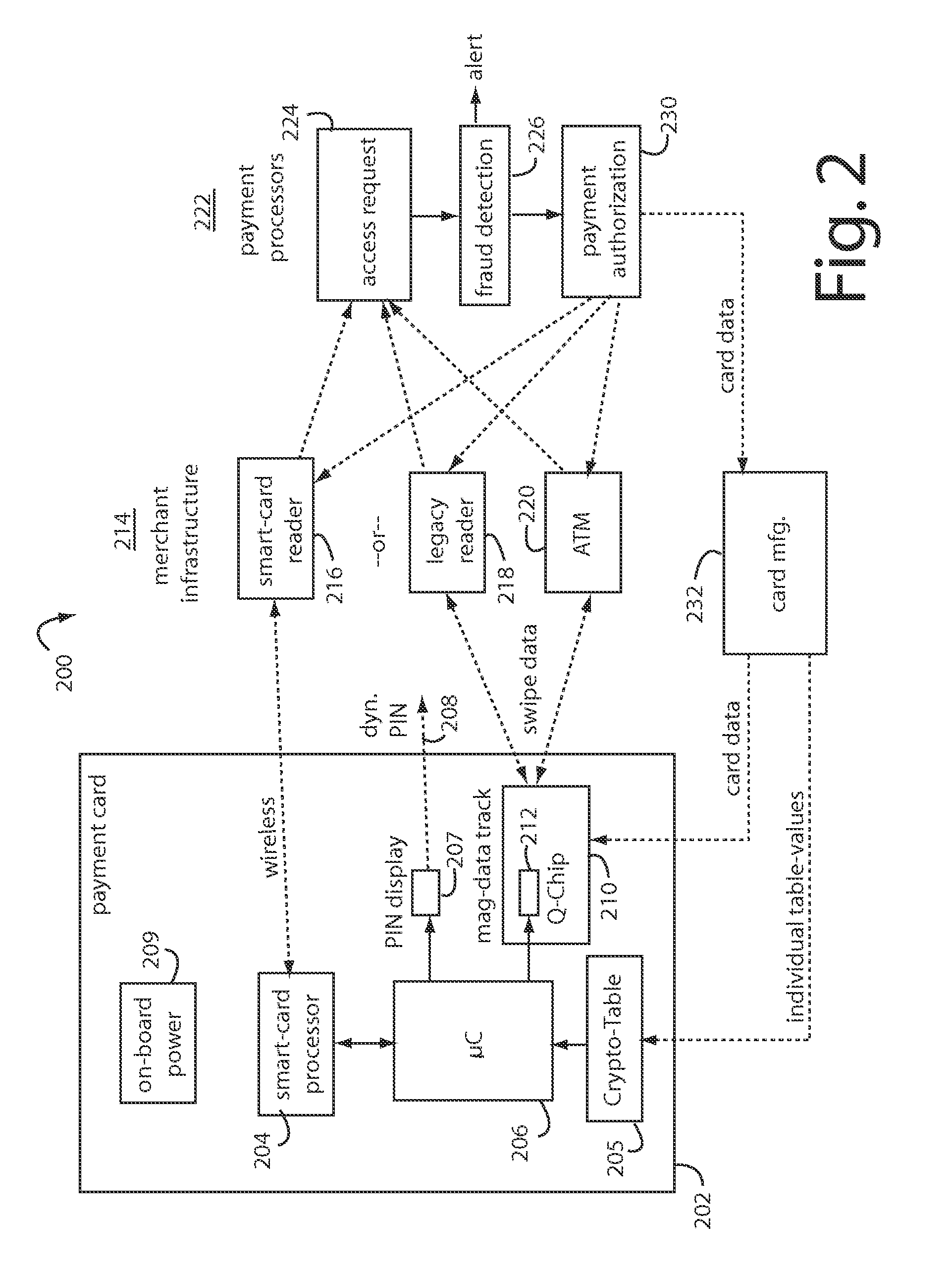

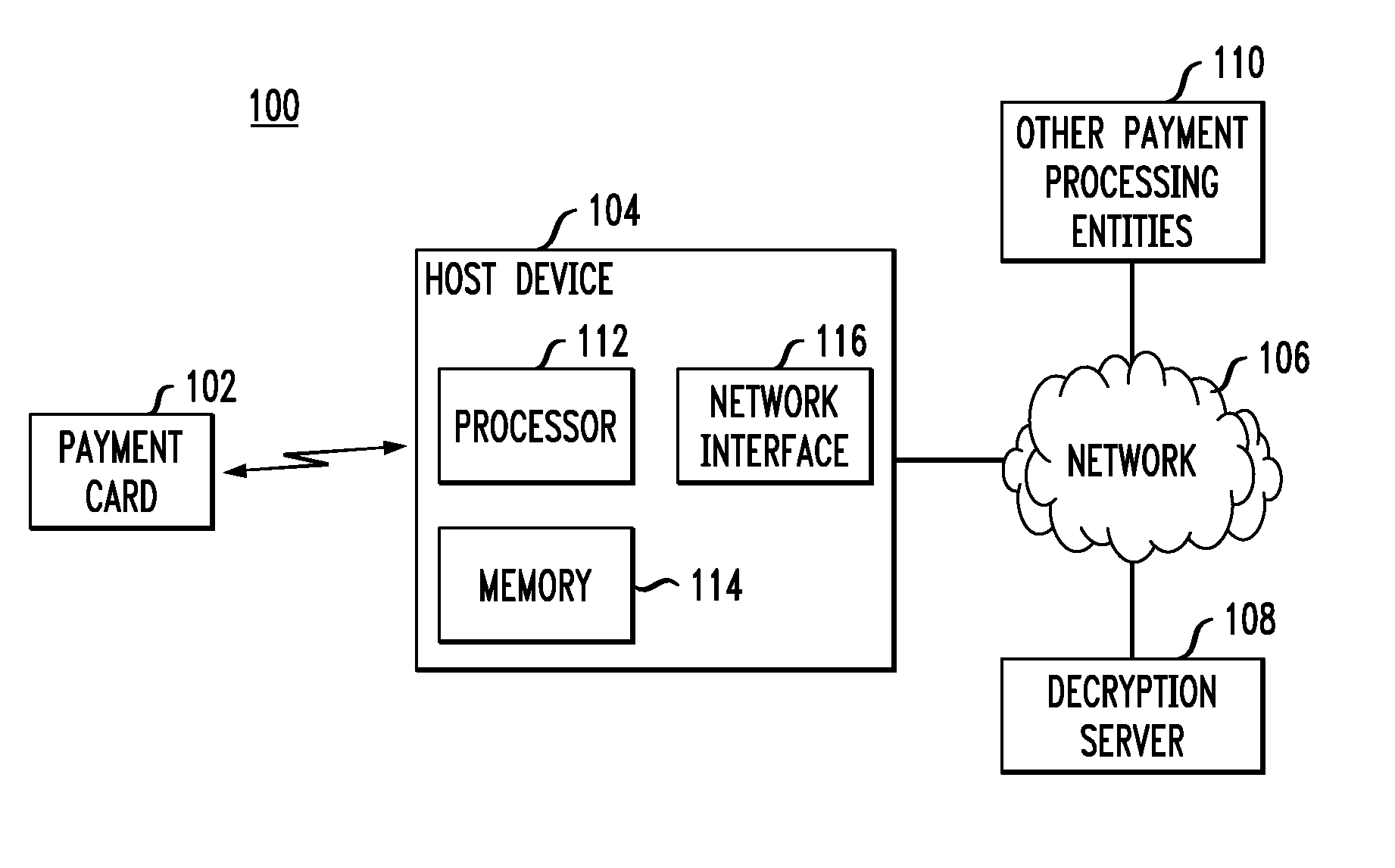

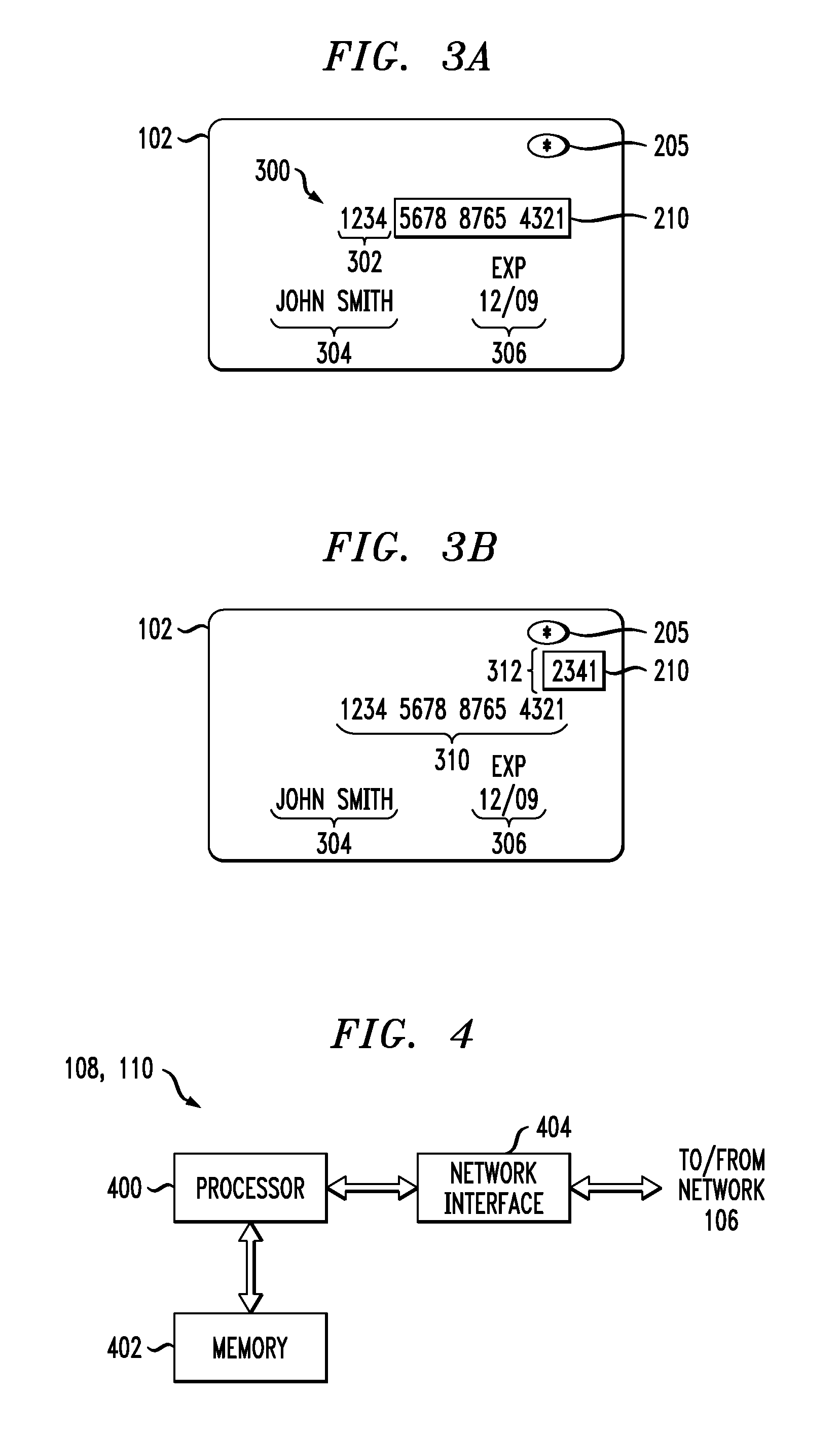

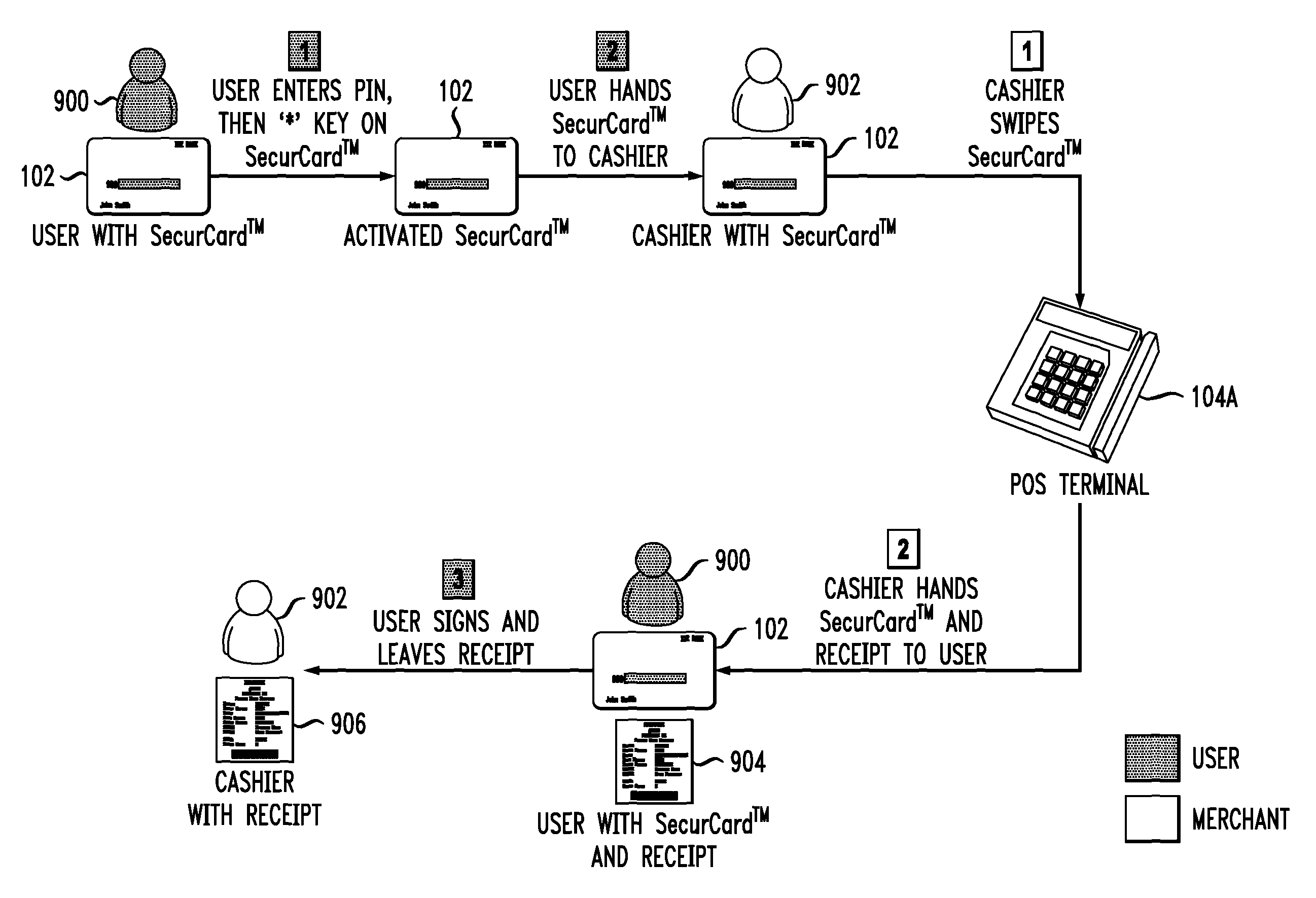

A payment card comprises an internal dynamic card verification value (CVV) generator and a user display for card-not-present transactions. Card-present transactions with merchant card readers are enabled by a dynamic magnetic array internally associated with the card's magnetic stripe. The user display and a timer are triggered by the user when the user needs to see the card verification value and / or begin a new transaction. A new card verification value is provided for each new transaction according to a cryptographic process, but the timer limits how soon a next new card verification value can be generated.

Owner:FITBIT INC

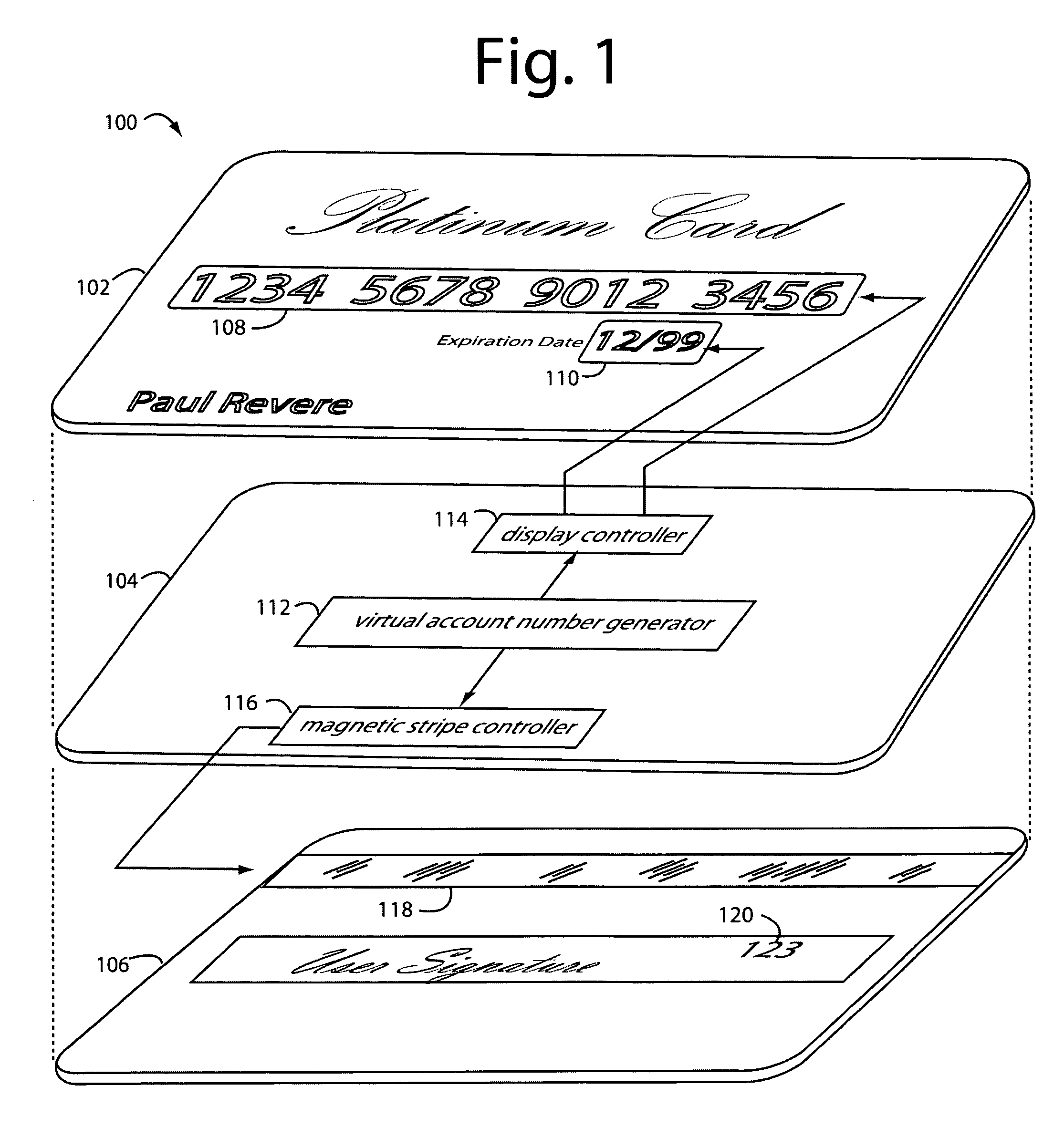

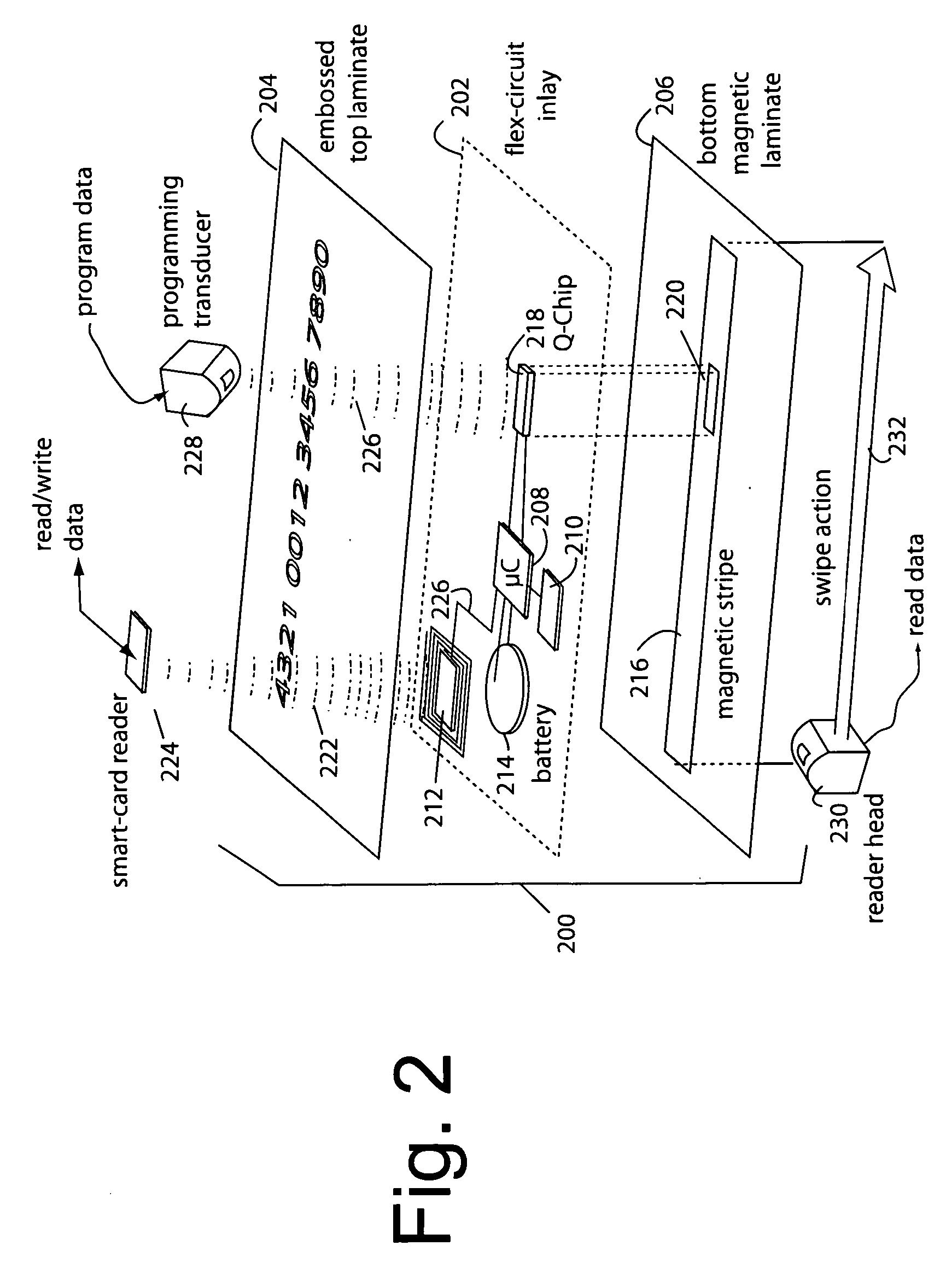

Payment card with internally generated virtual account numbers for its magnetic stripe encoder and user display

A payment card comprises an internal virtual account number generator and a user display for online transactions. Offline transactions with merchant card readers are enabled by a magnetic array positioned behind the card's magnetic stripe on the back. The internal virtual account number generator is able to program the magnetic bits encoded in the magnetic stripe to reflect the latest virtual account number. The internal virtual account number generator produces a sequence of virtual numbers that can be predicted and approved by the issuing bank. Once a number is used, it is discarded and put on an exclusion list.

Owner:FITBIT INC

Financial transactions with dynamic card verification values

ActiveUS20070136211A1Sufficient dataComputer security arrangementsPayment architectureUser needsPower user

A payment card comprises an internal dynamic card verification value (CVV) generator and a user display for card-not-present transactions. Card-present transactions with merchant card readers are enabled by a dynamic magnetic array internally associated with the card's magnetic stripe. The user display and a timer are triggered by the suer when the user needs to see the card verification value and / or begin a new transaction. A new card verification value is provided for each new transaction according to a cryptographic process, but the timer limits how soon a next new card verification value can be generated.

Owner:FITBIT INC

Payment card financial transaction authenticator

InactiveUS20080201264A1Sufficient dataAcutation objectsFinanceCryptographic nonceFinancial transaction

A payment card financial transaction authenticates for providing overall financial network security computes a number of results from a cryptographic key that match values that were selectively used to personalize individual payment cards with their individual user identification and account access codes. An account access code is later presented daring a financial transaction involving at least one of those individual payment cards. A dynamic portion is included in a merchant's magnetic reading of the payment card. Then authenication can proceed by matching it with values computed from the cryptographic key.

Owner:FITBIT INC

Payment Card with Dynamic Account Number

ActiveUS20090048971A1Avoid processing delaysOvercomes drawbackAcutation objectsFinanceDisplay devicePayment order

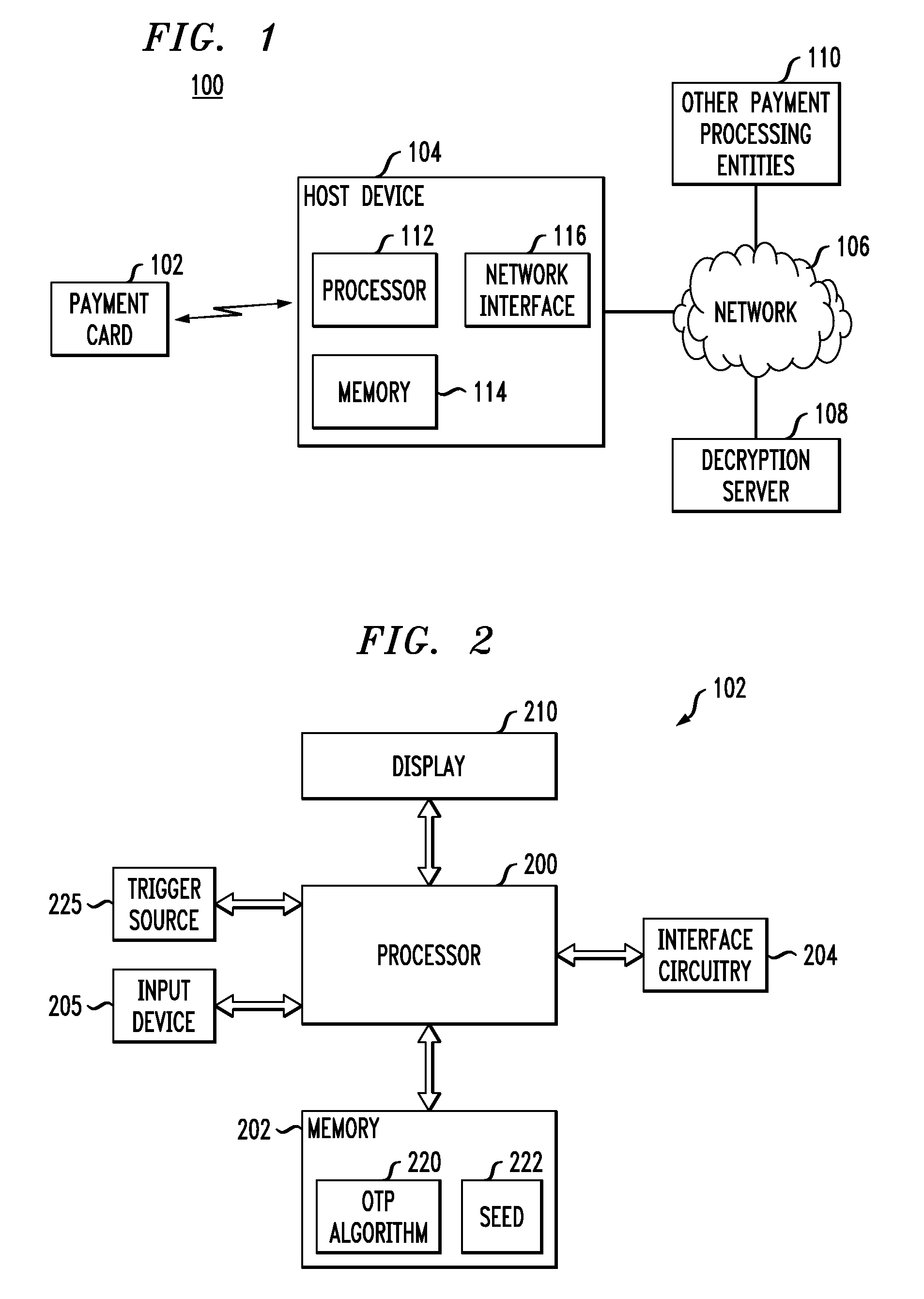

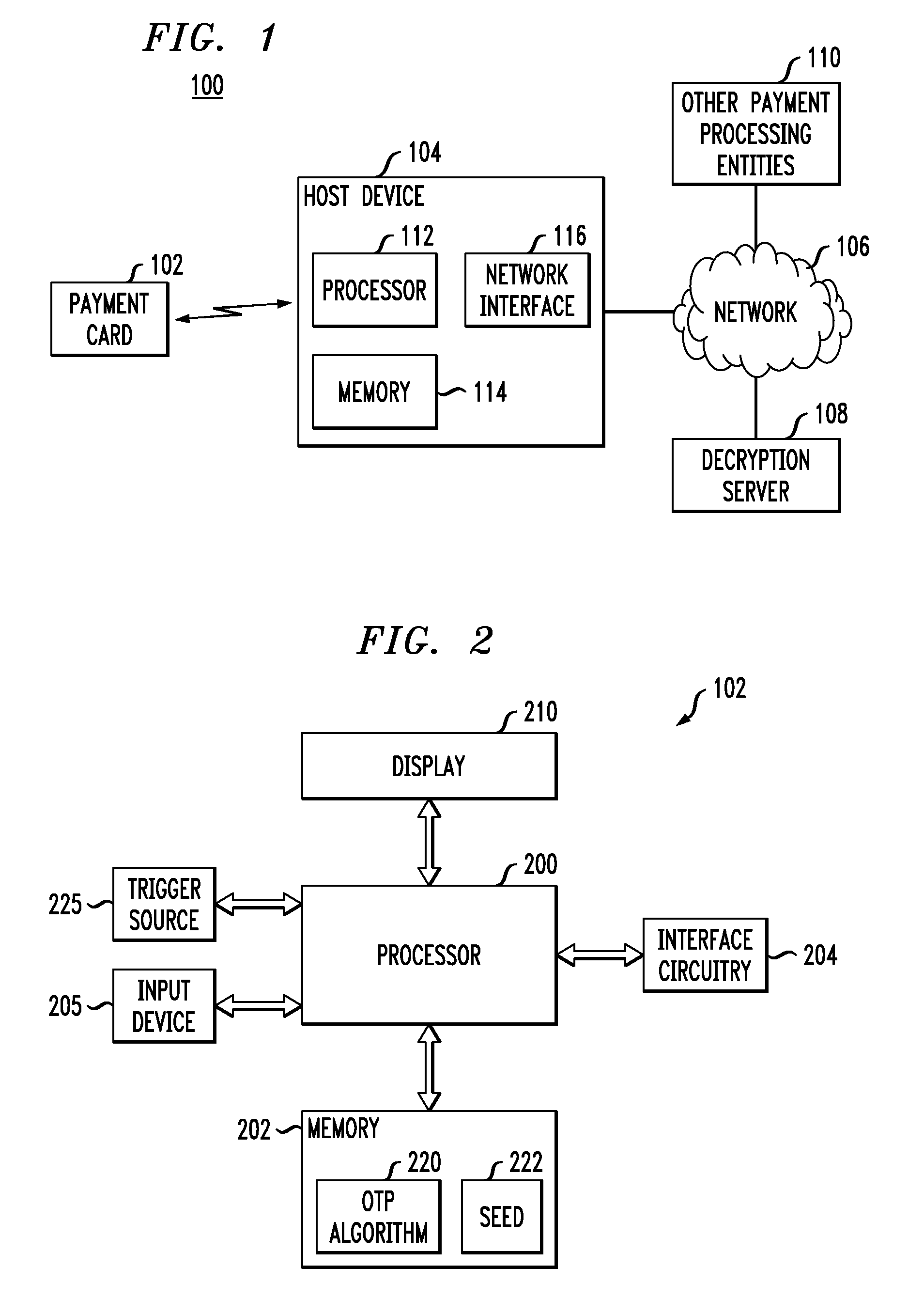

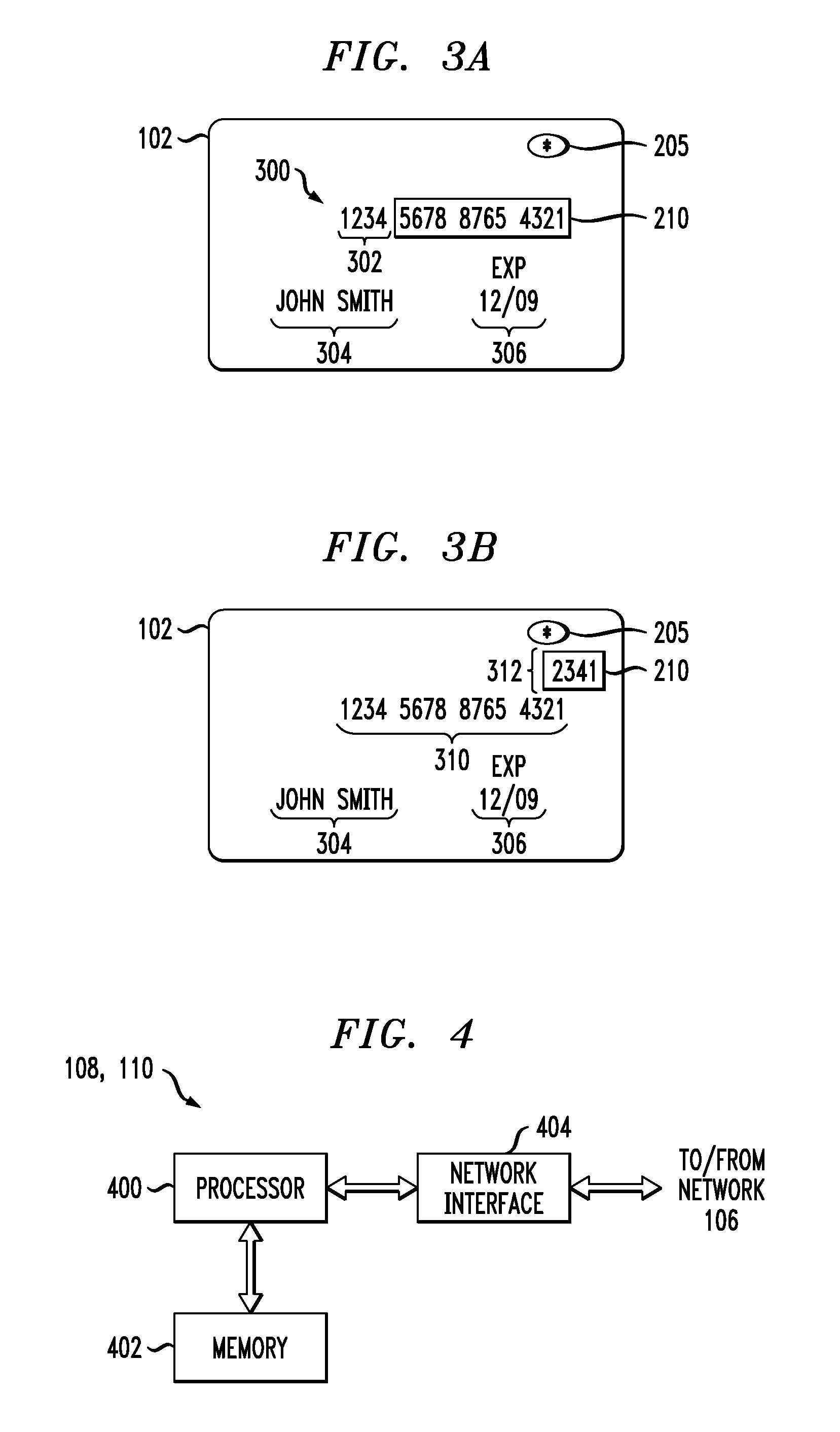

A payment card comprises a processor, a trigger source coupled to the processor, and a display for outputting at least a portion of a dynamic account number under control of the processor responsive to the trigger source. The dynamic account number is determined based at least in part on a seed stored in the payment card and an output of the trigger source. In an illustrative embodiment, the dynamic account number is generated utilizing a time-based or event-based one-time password algorithm. For example, in a time-based embodiment, the trigger source may comprise a time of day clock, with the dynamic account number being determined based at least in part on the seed and a current value of the time of day clock. In an event-based embodiment, the trigger source may comprise an event counter, with the dynamic account number being determined based at least in part on the seed and a current value of the event counter.

Owner:EMC IP HLDG CO LLC

Transaction system

InactiveUS6236981B1Improve securityImprove the level ofUser identity/authority verificationComputer security arrangementsService provisionThe Internet

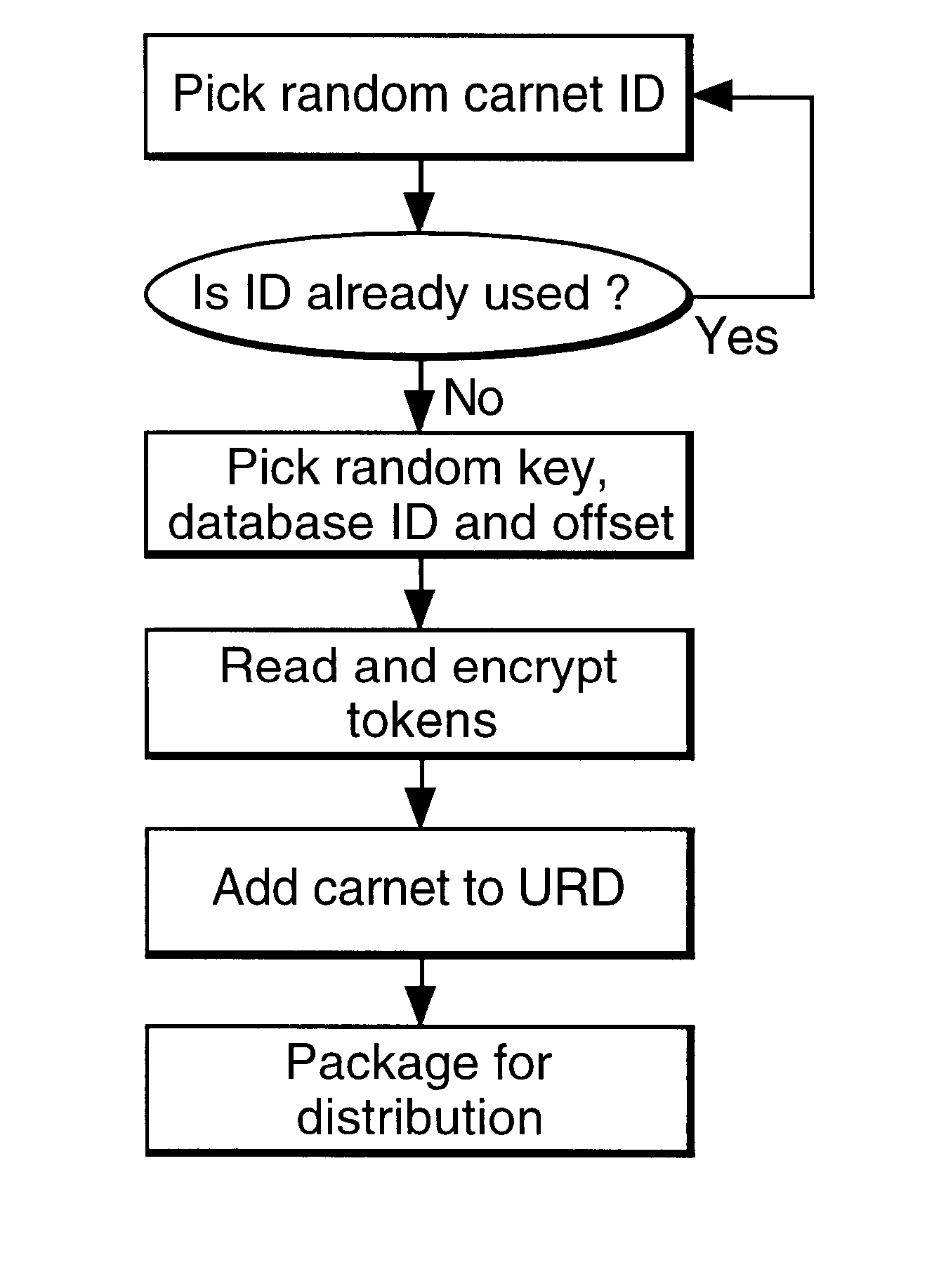

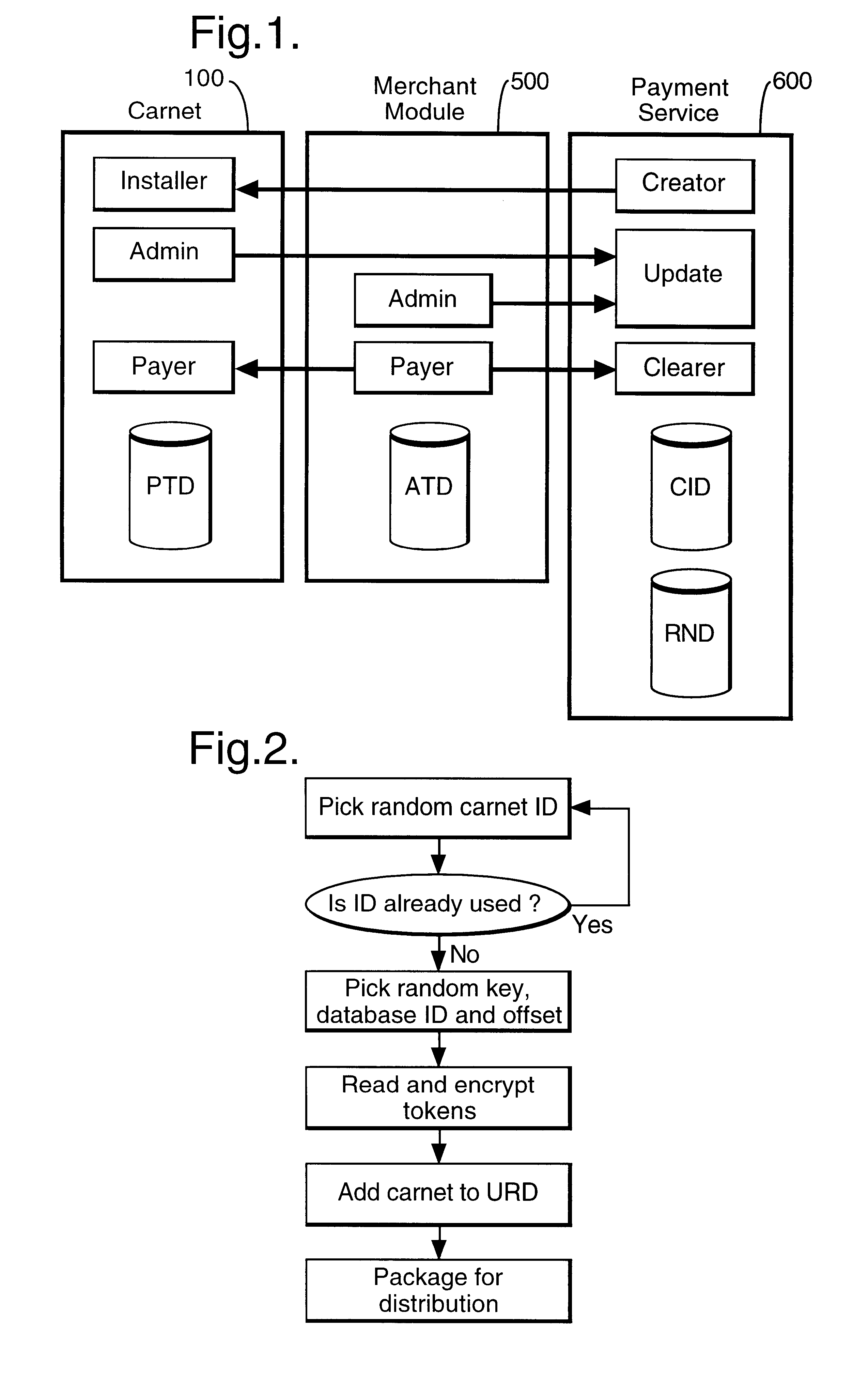

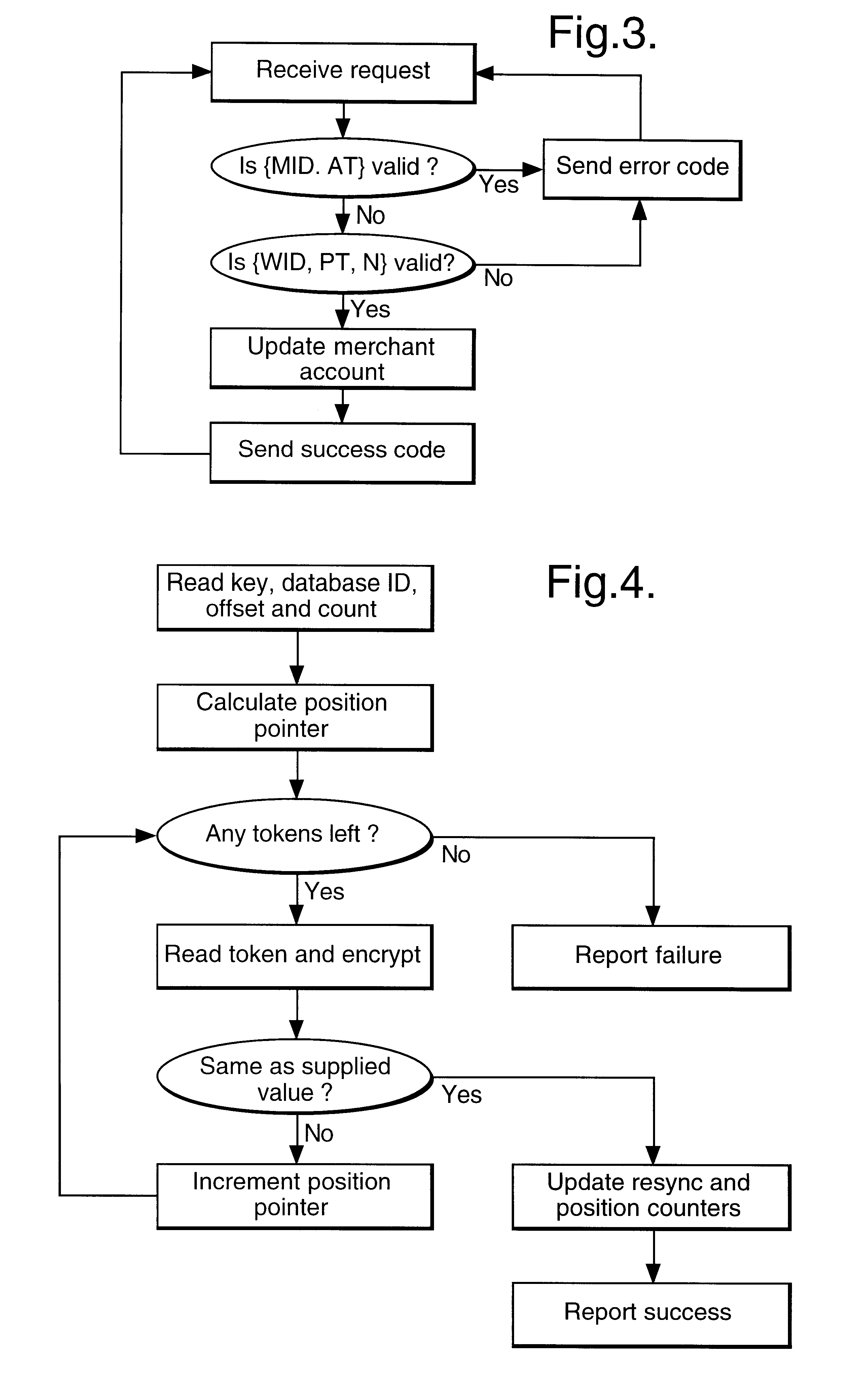

In a digital payment system, a sequence of random numbers is stored at a payment service. A set of digitally encoded random numbers derived from the stored sequence is issued to the user in return for payment. The tokens are stored in a Carnet. The user can then spend the tokens by transferring tokens to a merchant, for example, to an on-line service provider. The merchant returns each token received to the payment server. The payment server authenticates the token and transmits an authentication message to the merchant. The merchant, payment server and user may be linked by internet connections.

Owner:BRITISH TELECOMM PLC

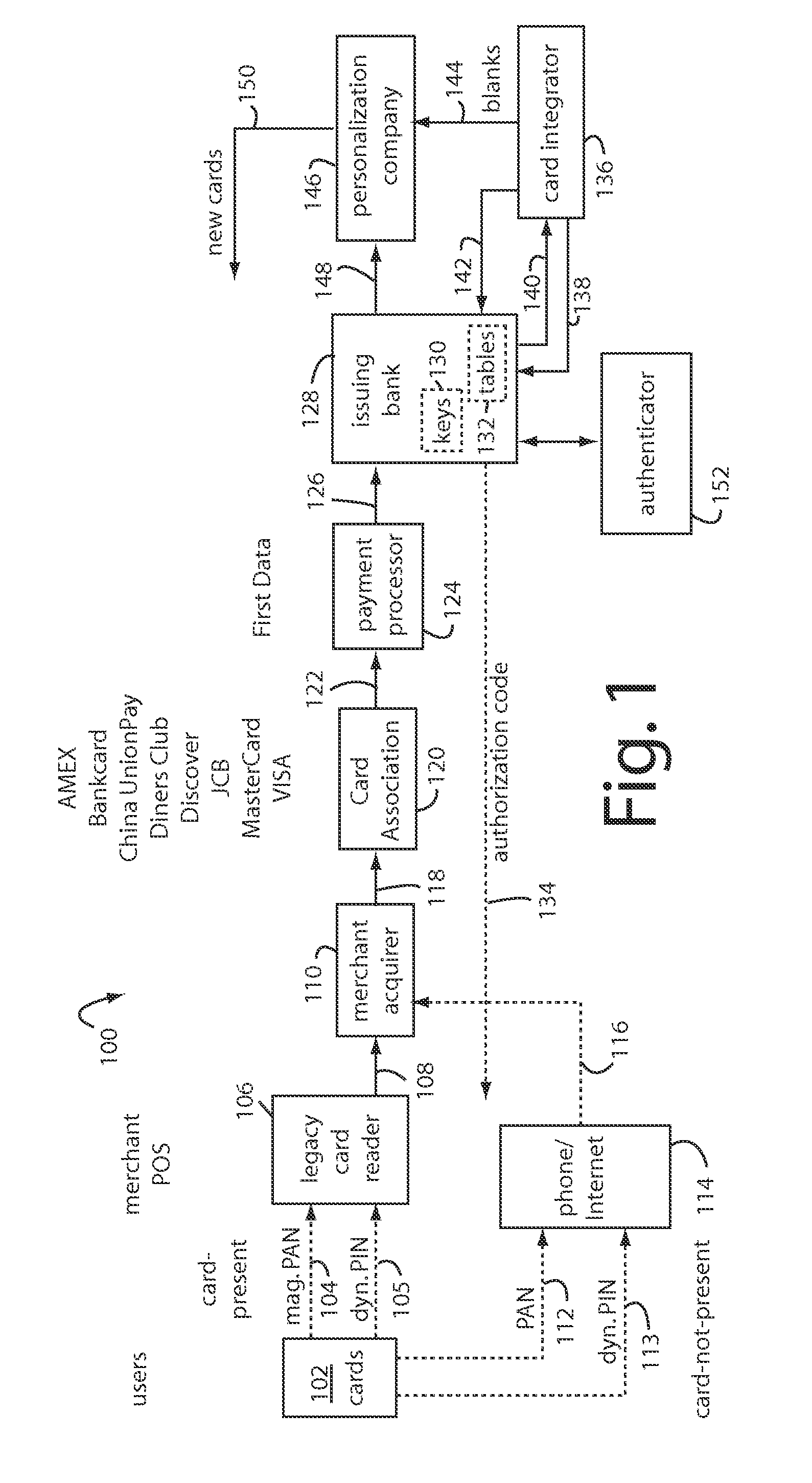

Financial transactions with dynamic personal account numbers

ActiveUS20070208671A1Sufficient dataComputer security arrangementsPayment architecturePersonalizationIssuing bank

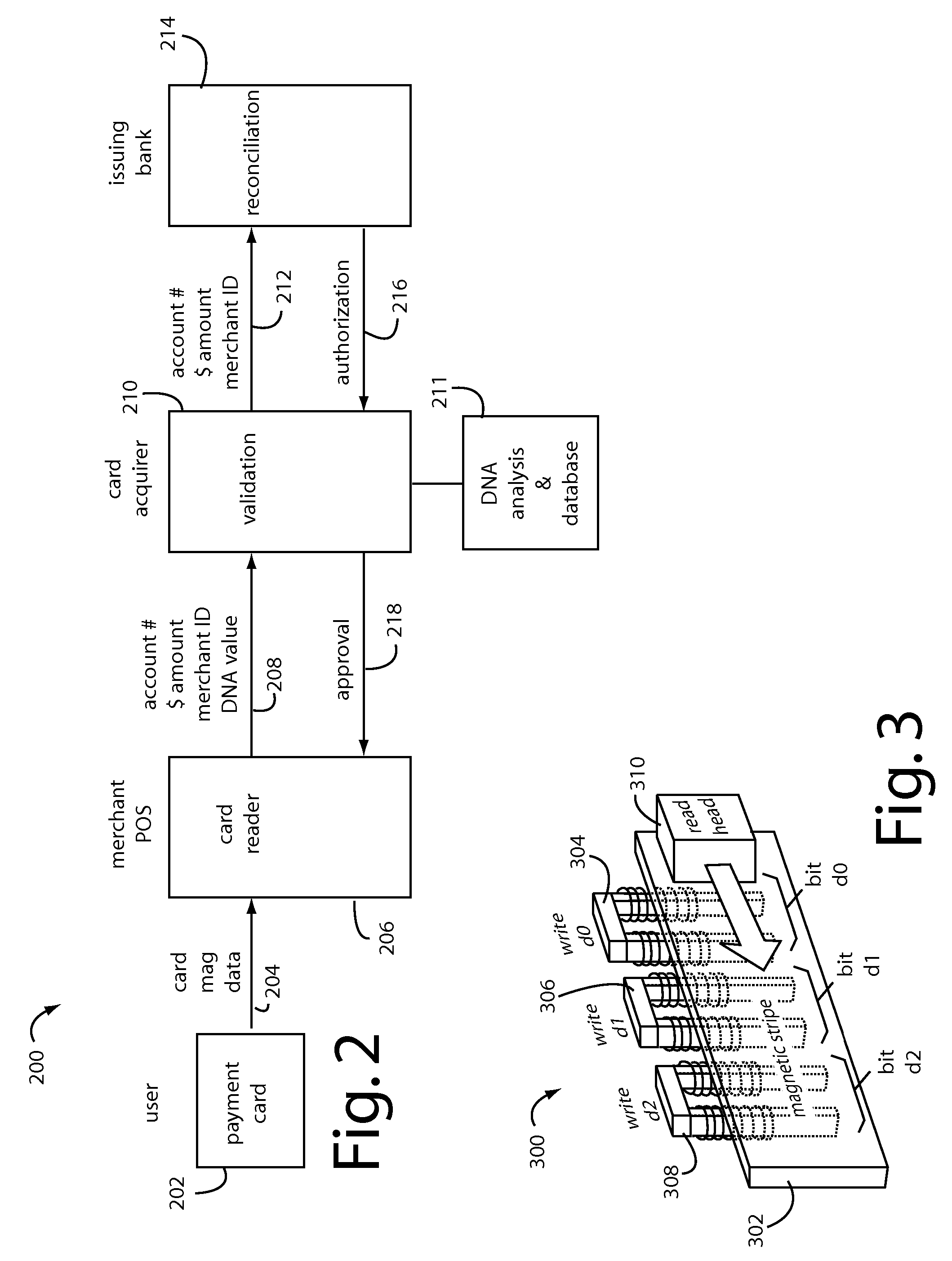

A method for securing financial transactions involving payment cards includes associating a sixteen-digit personal account number (PAN) with a particular payment card and user, wherein are included fields for a system number, a bank / product number, a user account number, and a check digit. A four-digit expiration date (MMYY) associated with the PAN. A magnetic stripe on the payment card is encoded with the PAN for periodic reading by a magnetic card reader during a financial transaction. A table of cryptographic values associated with the PAN and the MMYY is stored on each user's payment card during personalization by an issuing bank. A next financial transaction being commenced with the payment card is sensed. A cryptographic value from the table of cryptographic values is selected for inclusion as a dynamic portion of the user account number with the PAN when a next financial transaction is sensed. Any cryptographic value from the table of cryptographic values will not be used again in another financial transaction after being used once. The issuing bank authorizes the next financial transaction only if the PAN includes a correct cryptographic value in the user account number field.

Owner:FITBIT INC

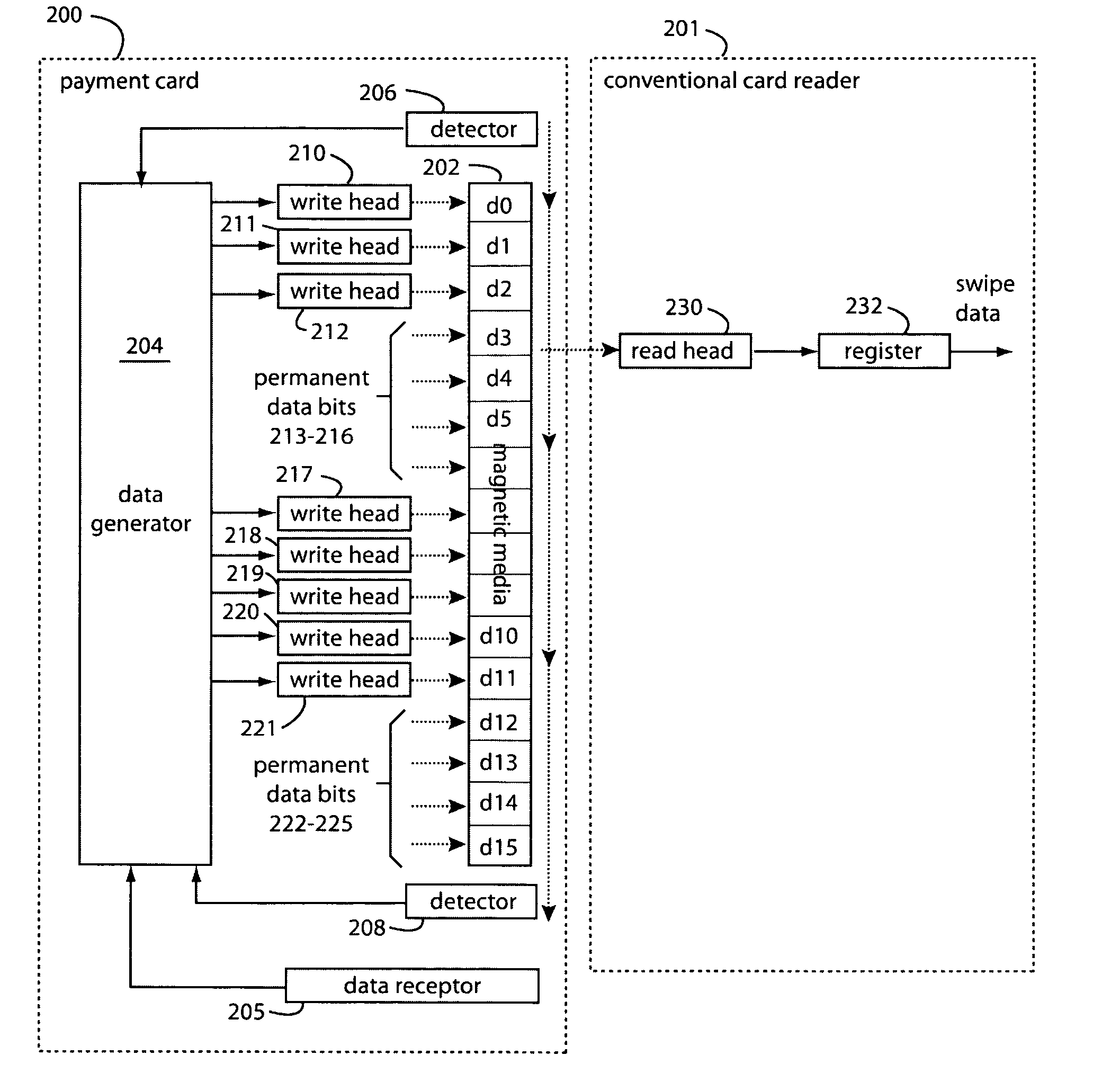

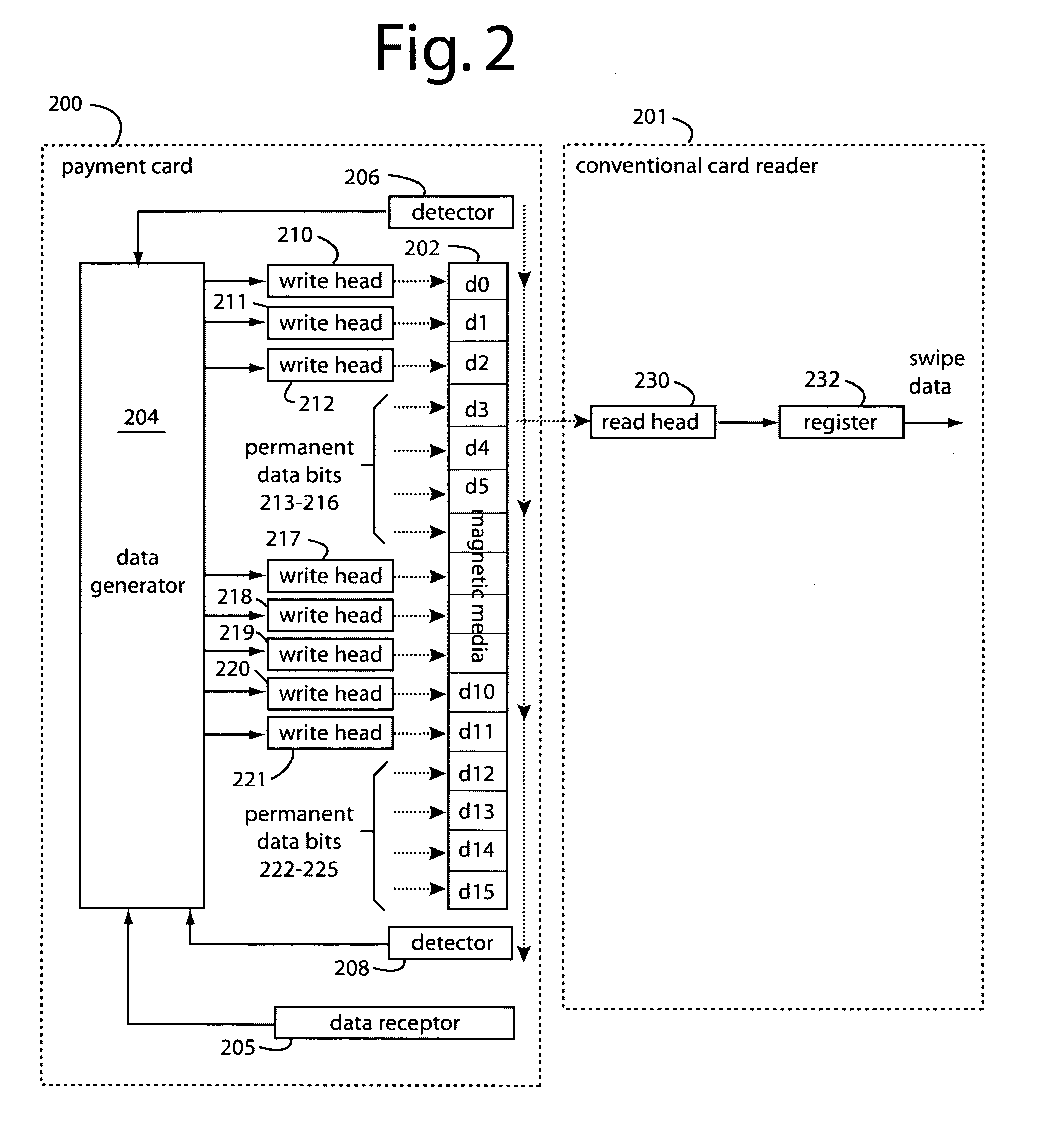

Payment card preloaded with unique numbers

ActiveUS7380710B2Reduce financial riskSimple and inexpensive and effectiveFinancePayment architectureFinancial transactionPayment order

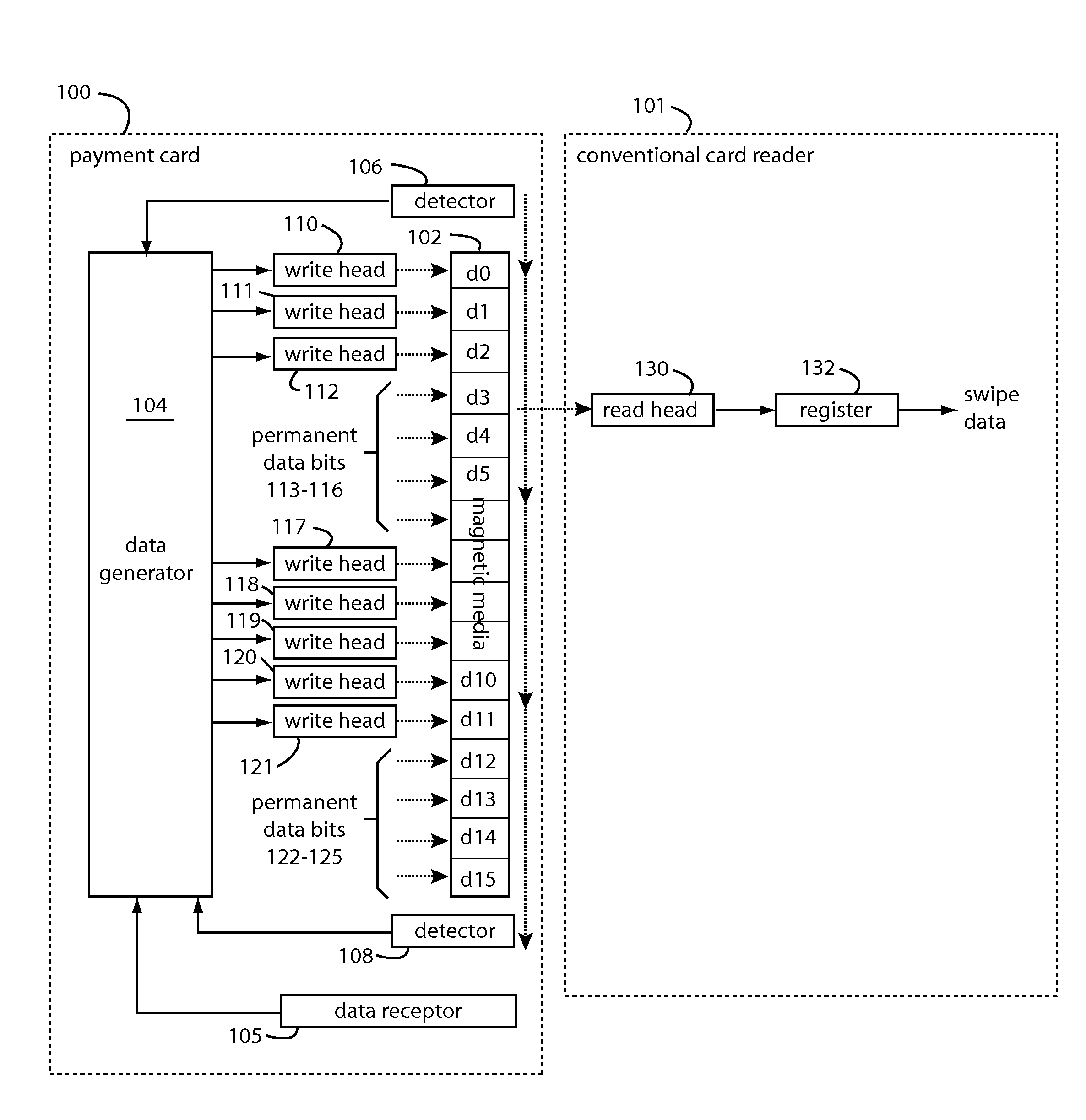

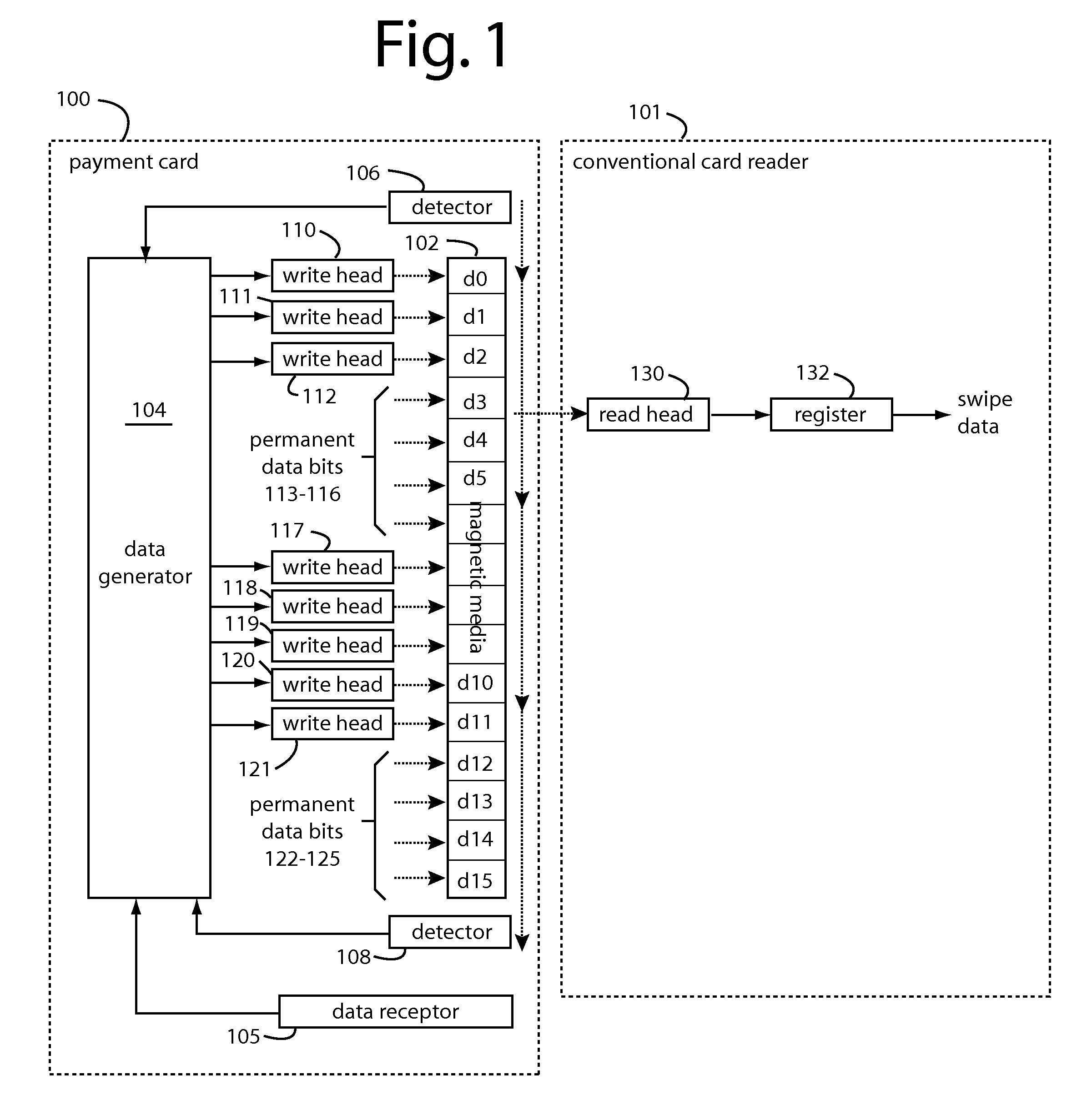

A conventional looking payment card comprises a plastic card with a legacy card reader compatible magnetic stripe for dynamic user account data. Internal to the plastic card, and behind the magnetic stripe, a number of fixed-position magnetic write heads allow the user account data to be modified autonomously. Electronics within the card are pre-loaded with many unique numbers that are selected for one-time use in financial transactions. A payment processing center keeps track of the unique numbers used, and knows which numbers to expect in future transactions. It will not authorize transaction requests if the unique number read during a magnetic card swipe is not as expected. A card-swipe detector embedded in the plastic card detects each use in a scanner, so changes can be made to the data bits sent to the write heads.

Owner:FITBIT INC

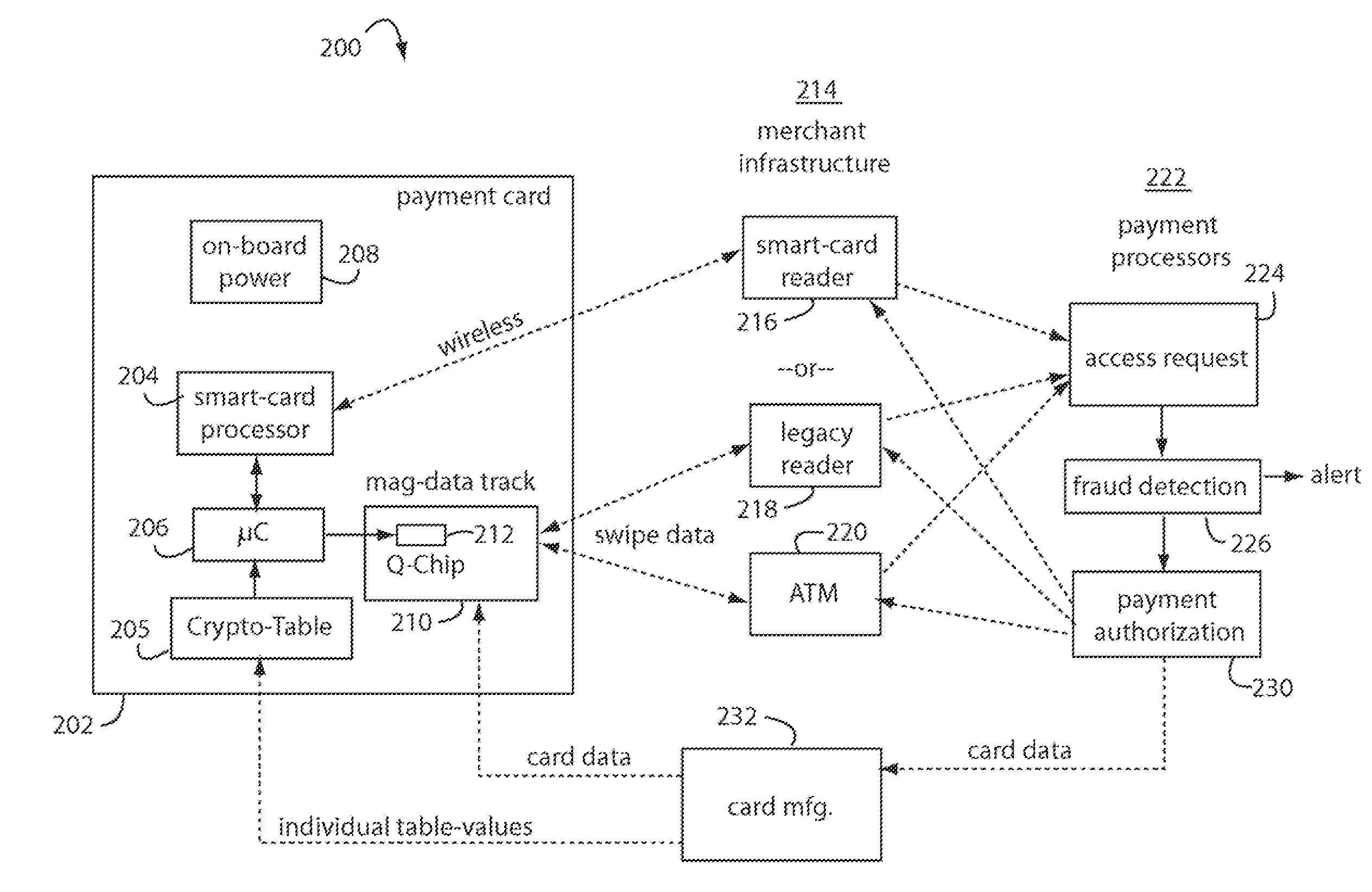

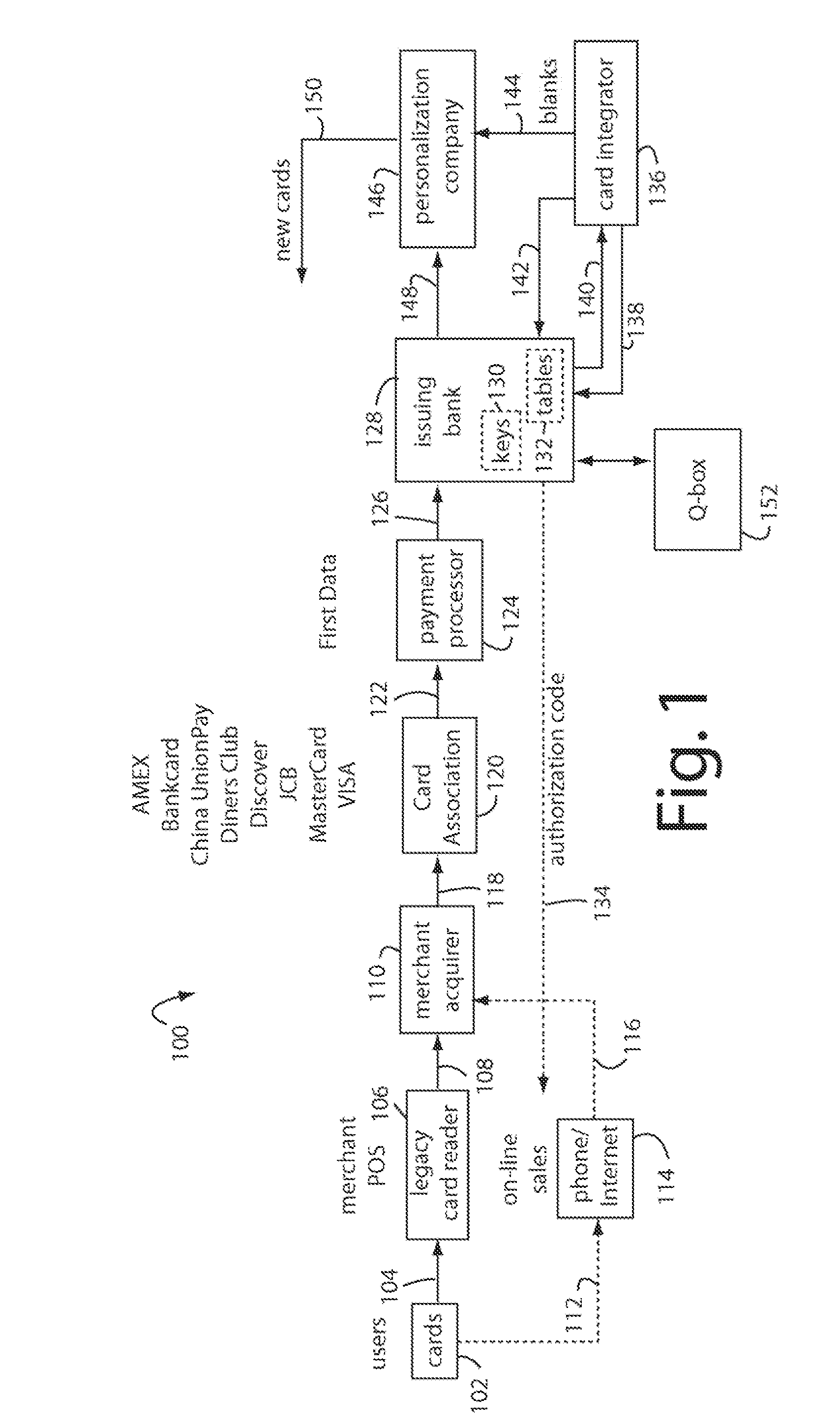

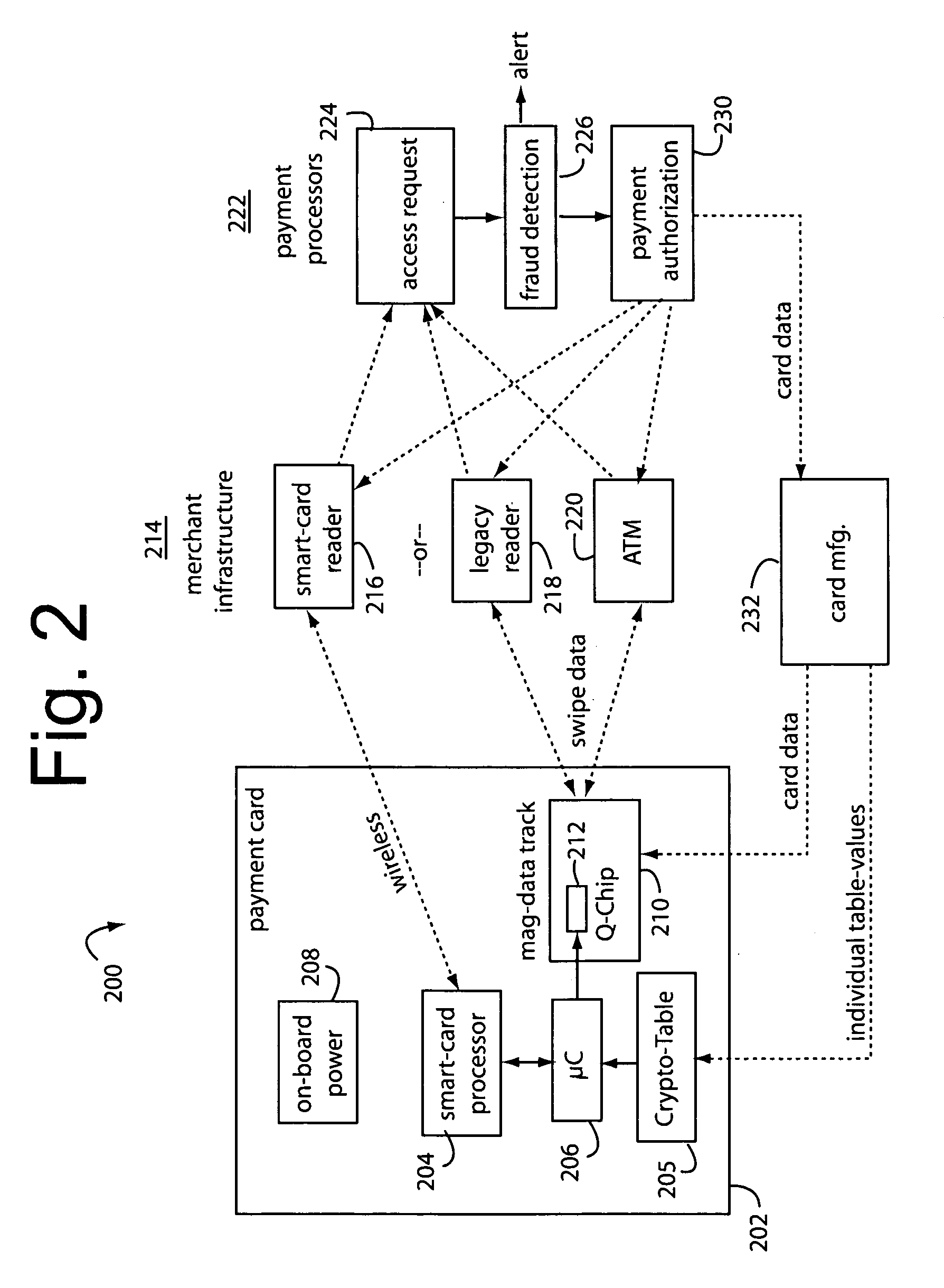

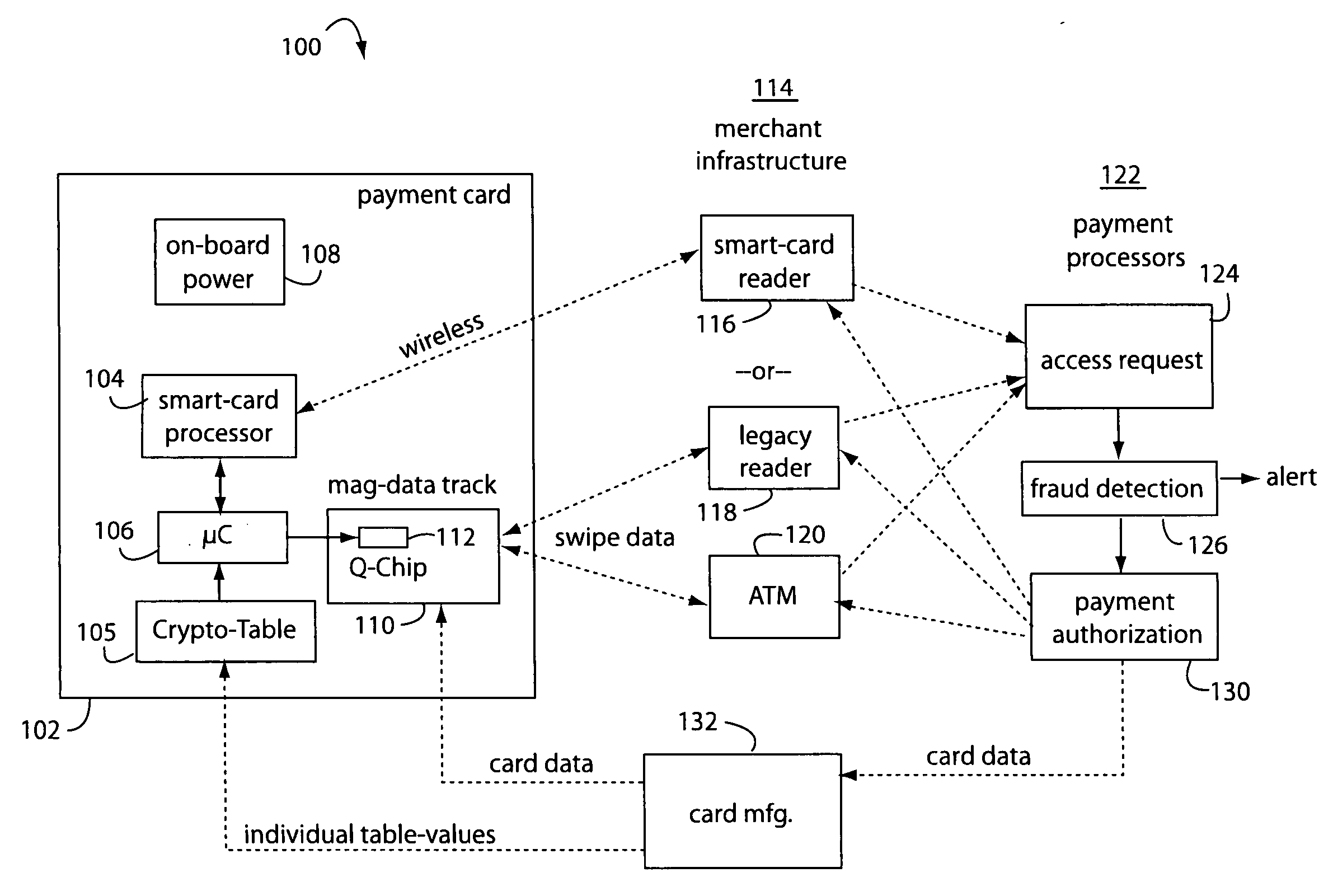

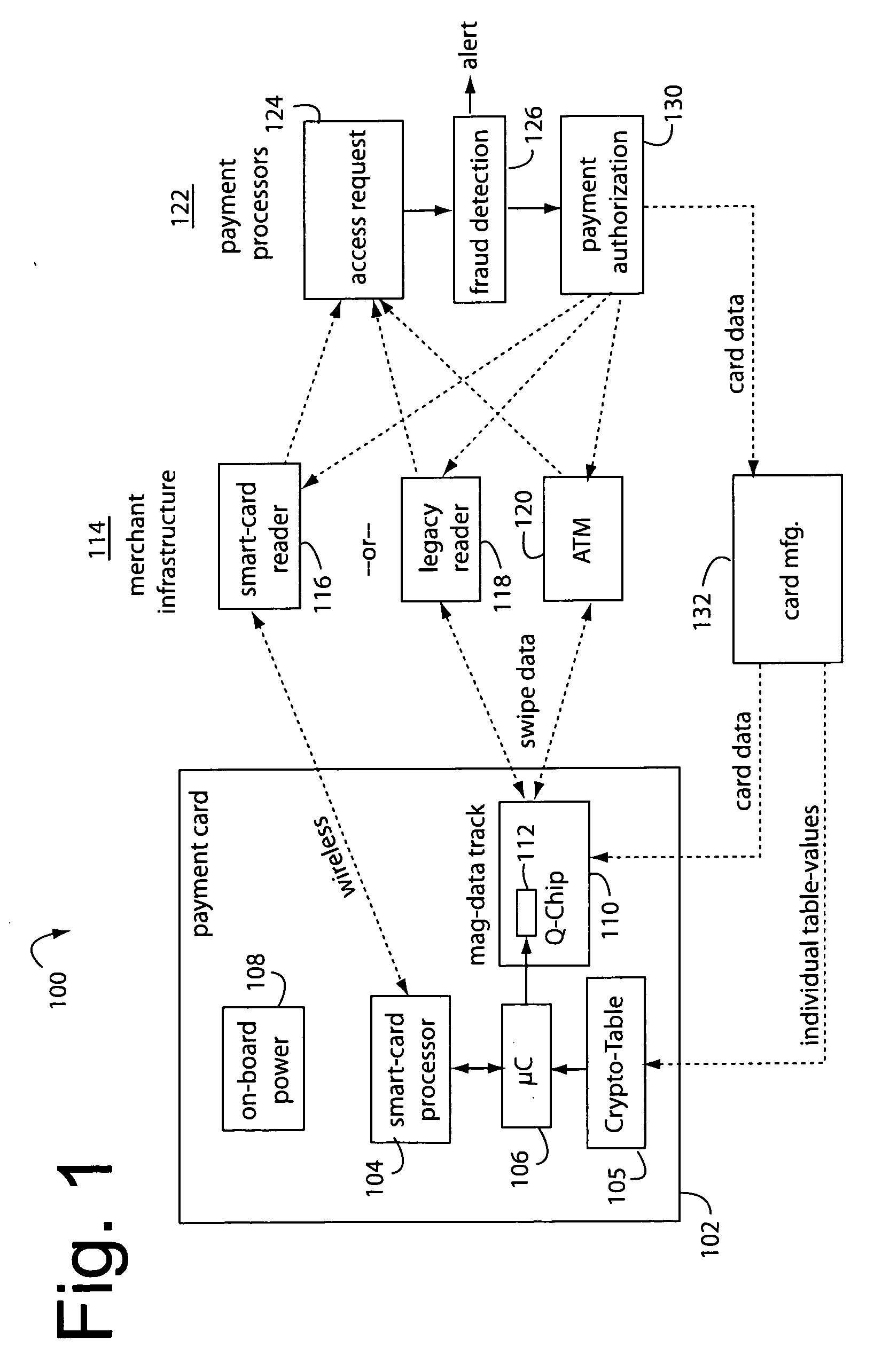

Financial transaction payment processor

InactiveUS20090006262A1Sufficient dataAcutation objectsSynchronising transmission/receiving encryption devicesPayment orderFinancial transaction

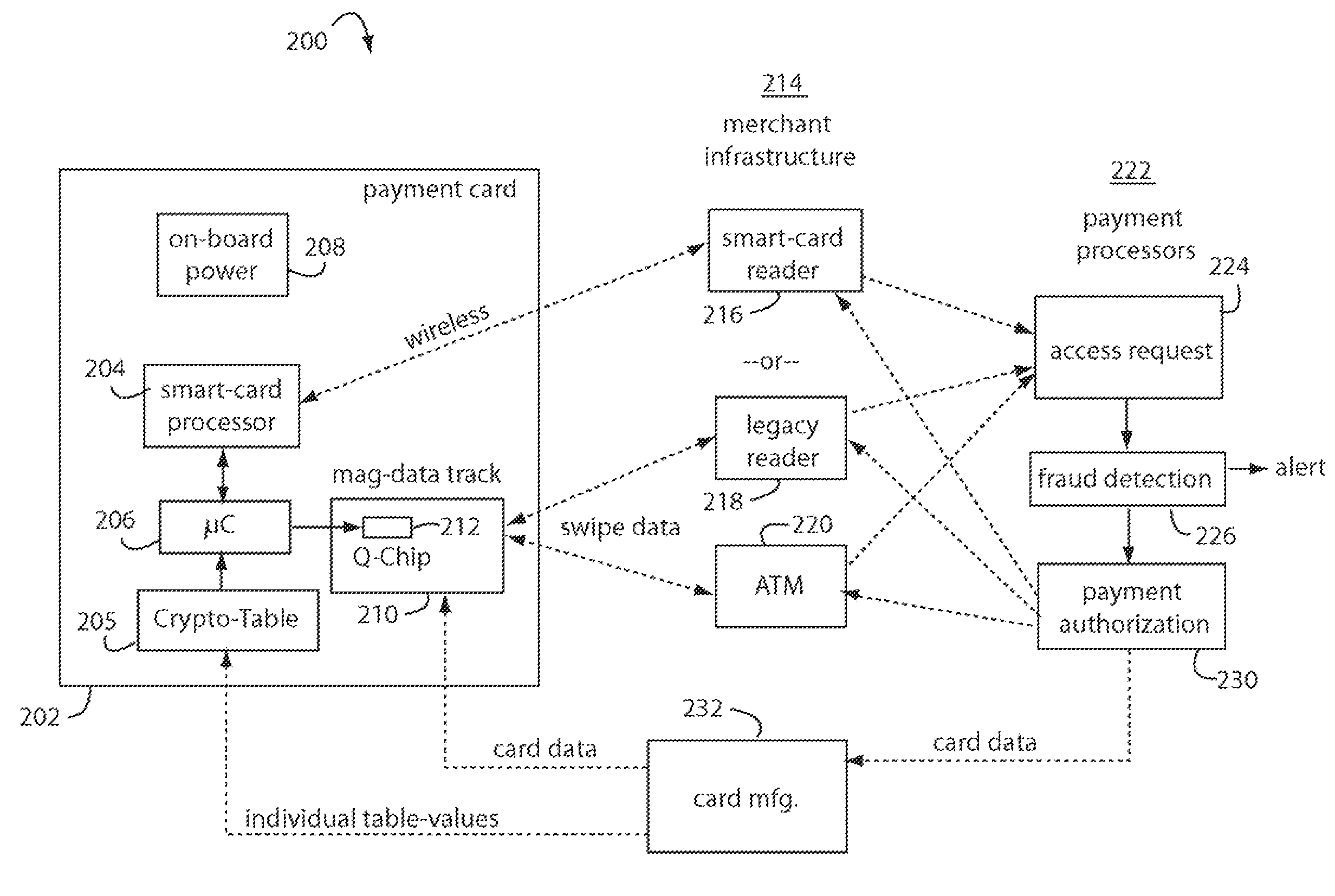

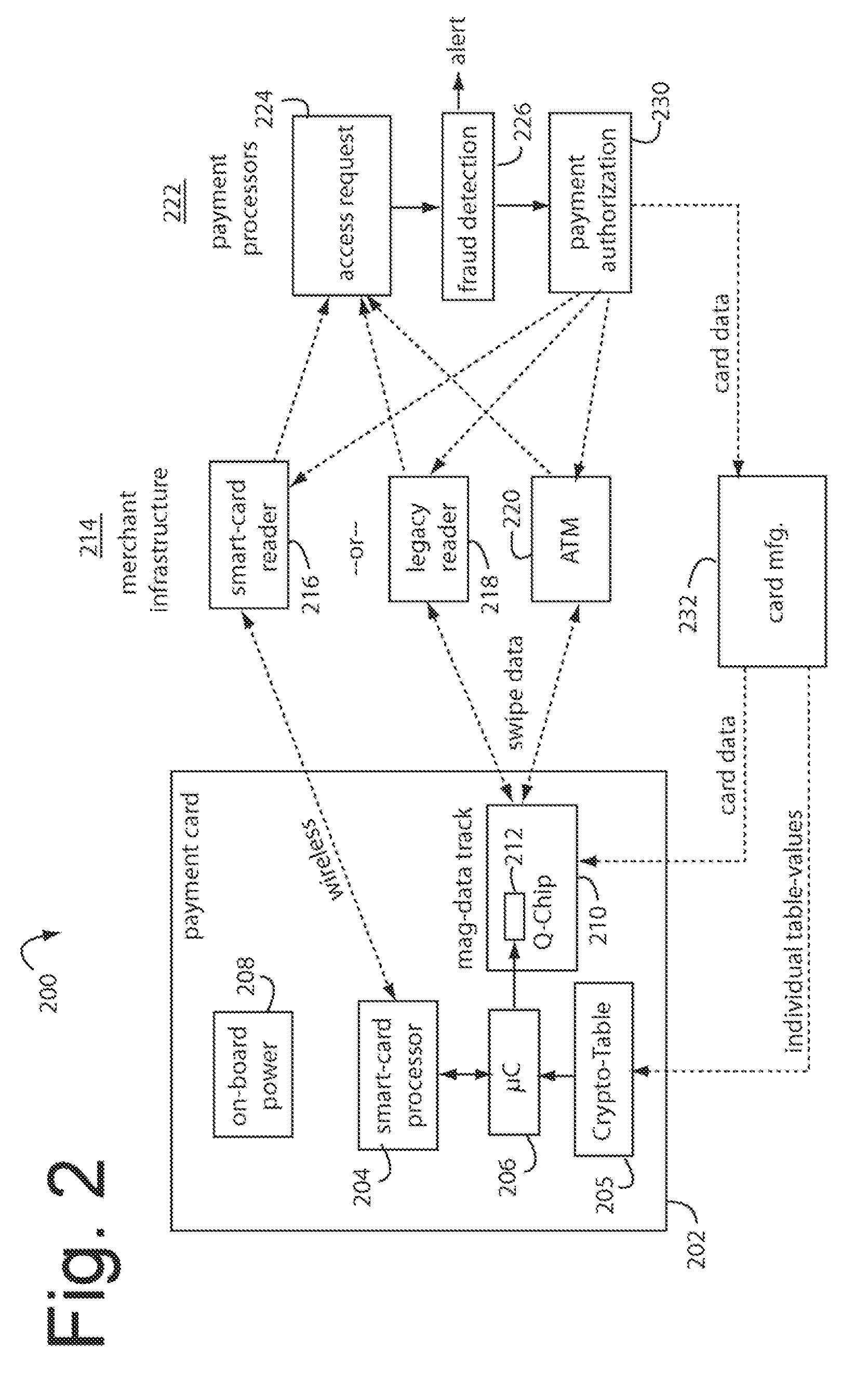

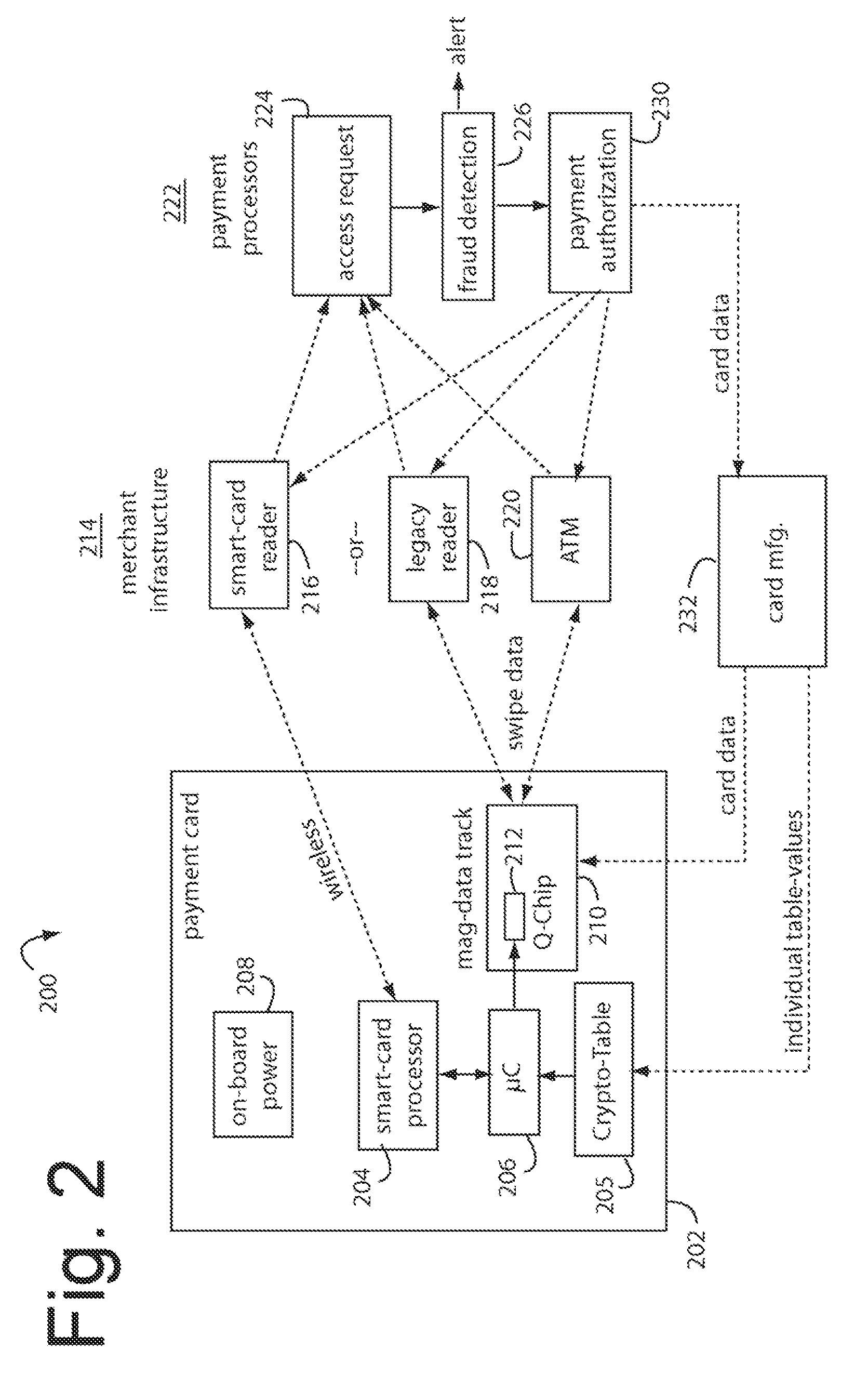

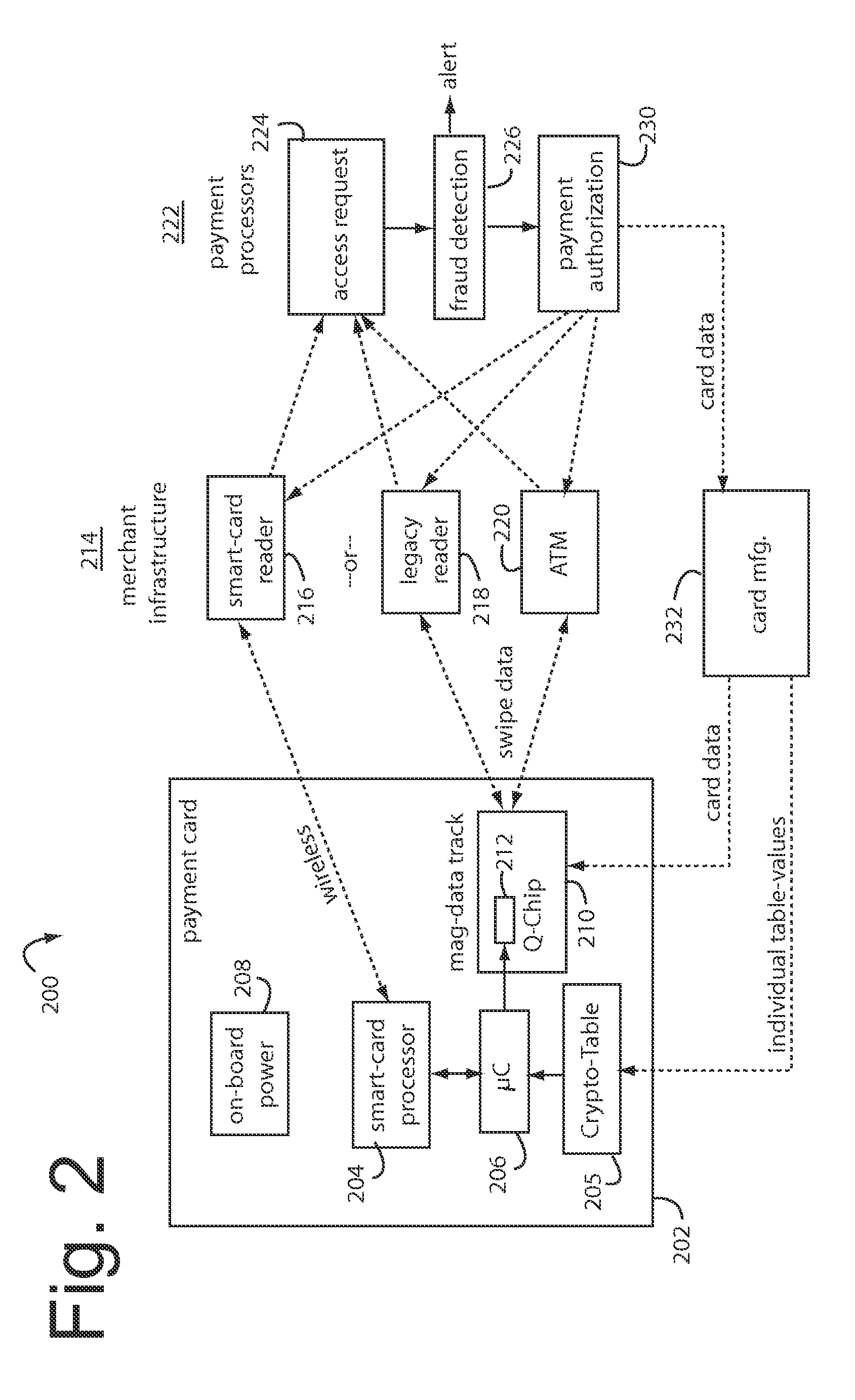

A financial transaction payment processor includes an account access request processor for receiving dynamic swipe data from a payment card through a merchant infrastructure. A fraud detection processor is connected to analyze a dynamic data obtained by the account access request processor that should agree with values pre-loaded in a Crypto-Table by a card manufacturer. A payment authorization processor is connected to receive a message from the fraud detection processor and to then forward a response to the merchant infrastructure.

Owner:FITBIT INC

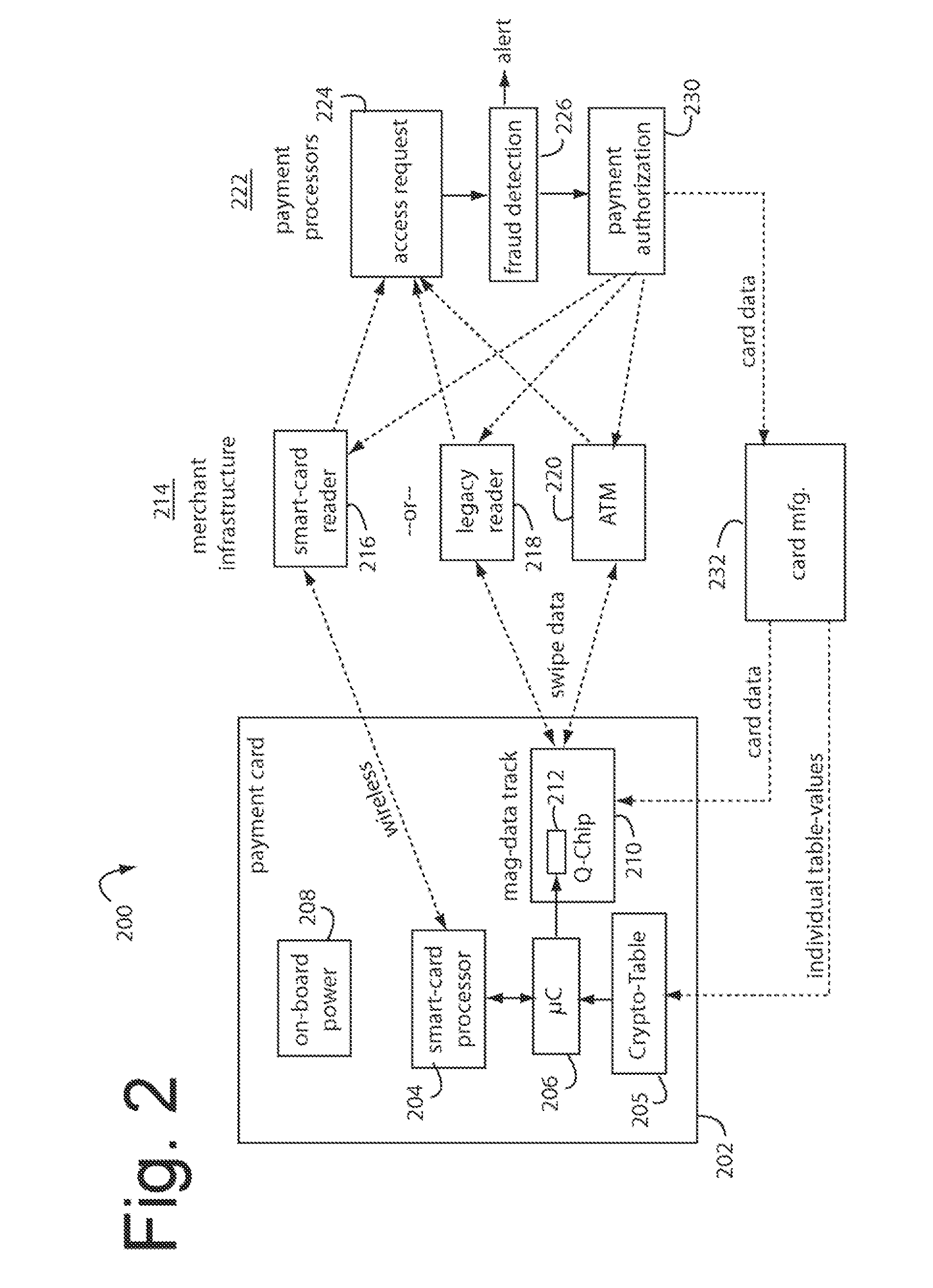

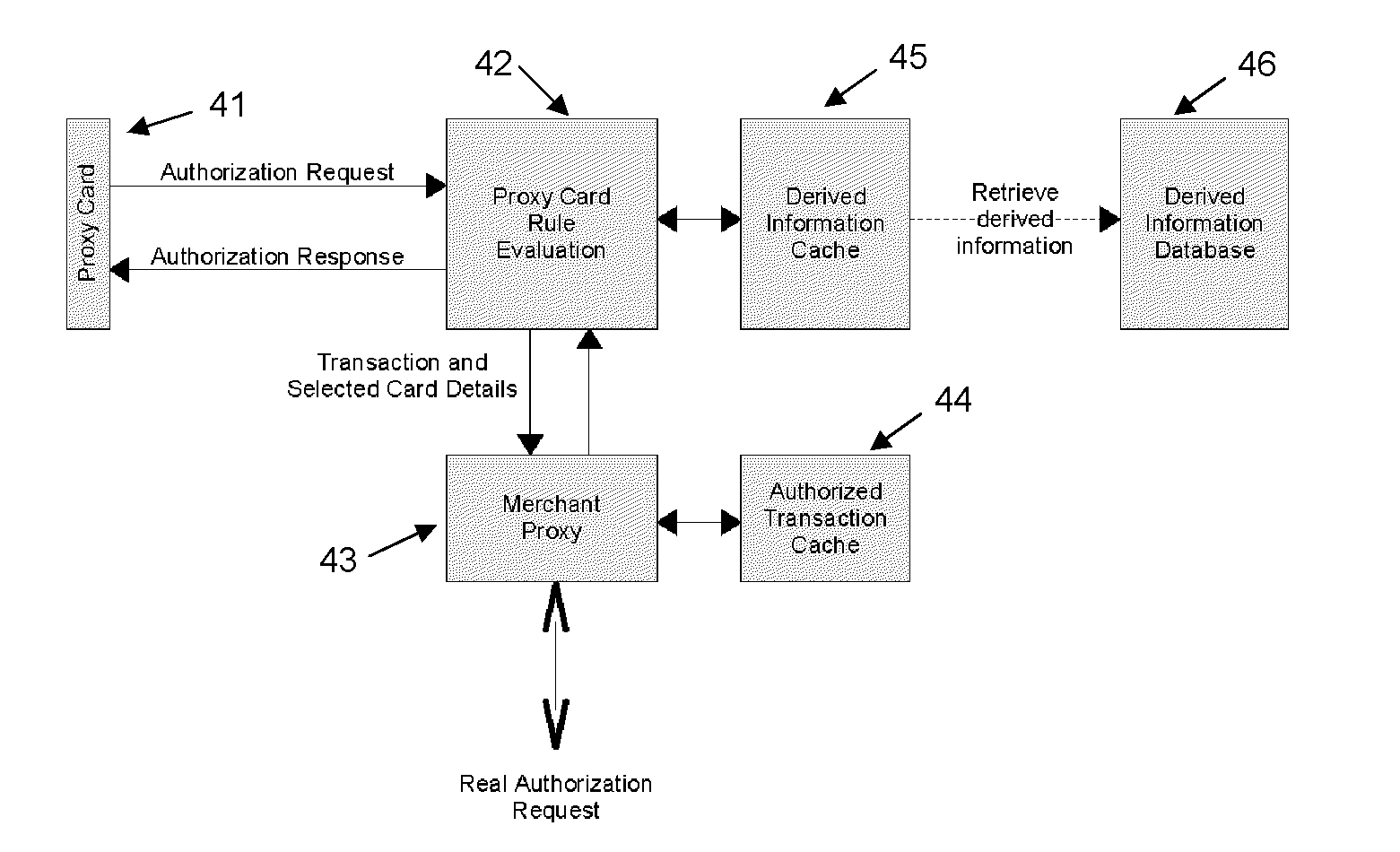

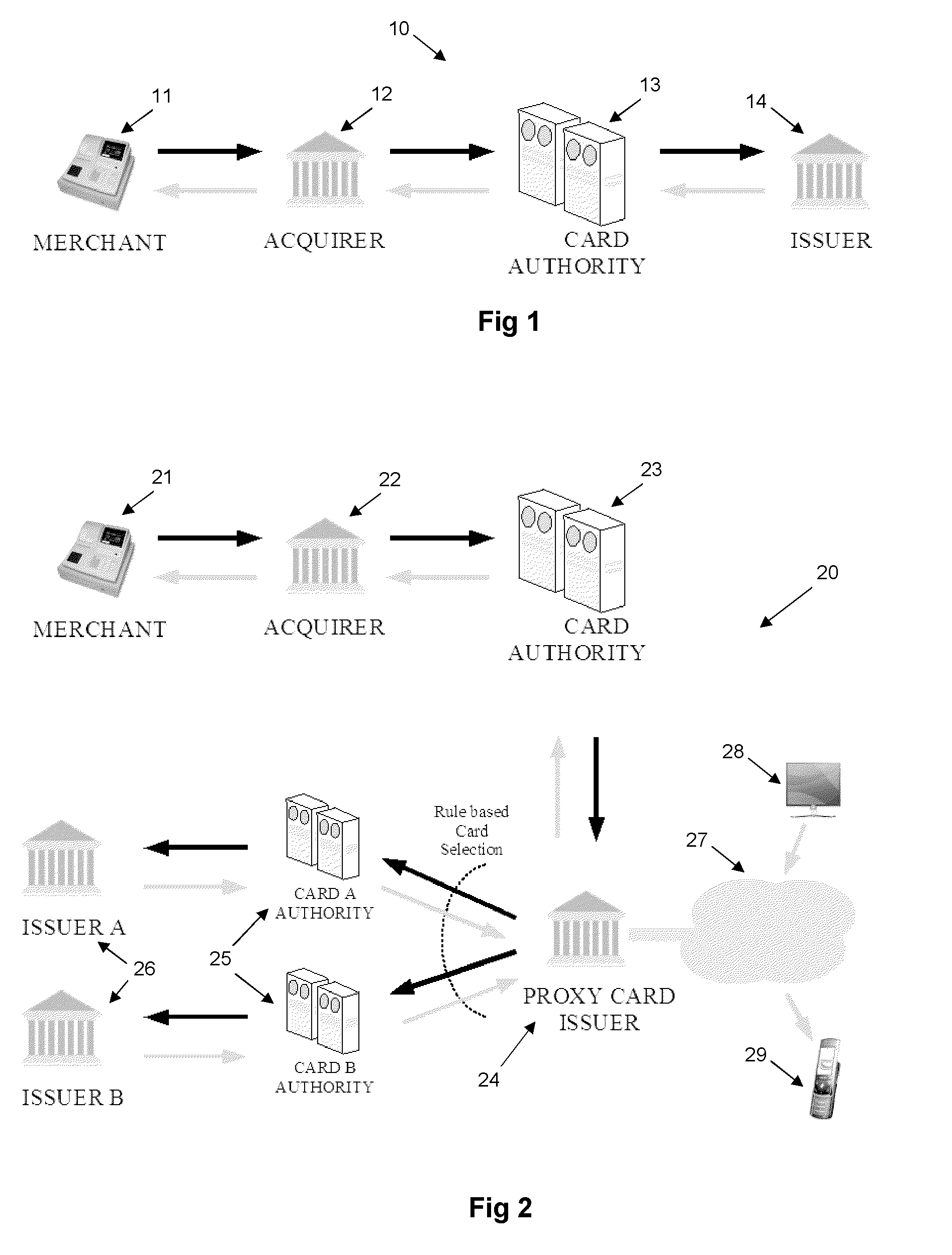

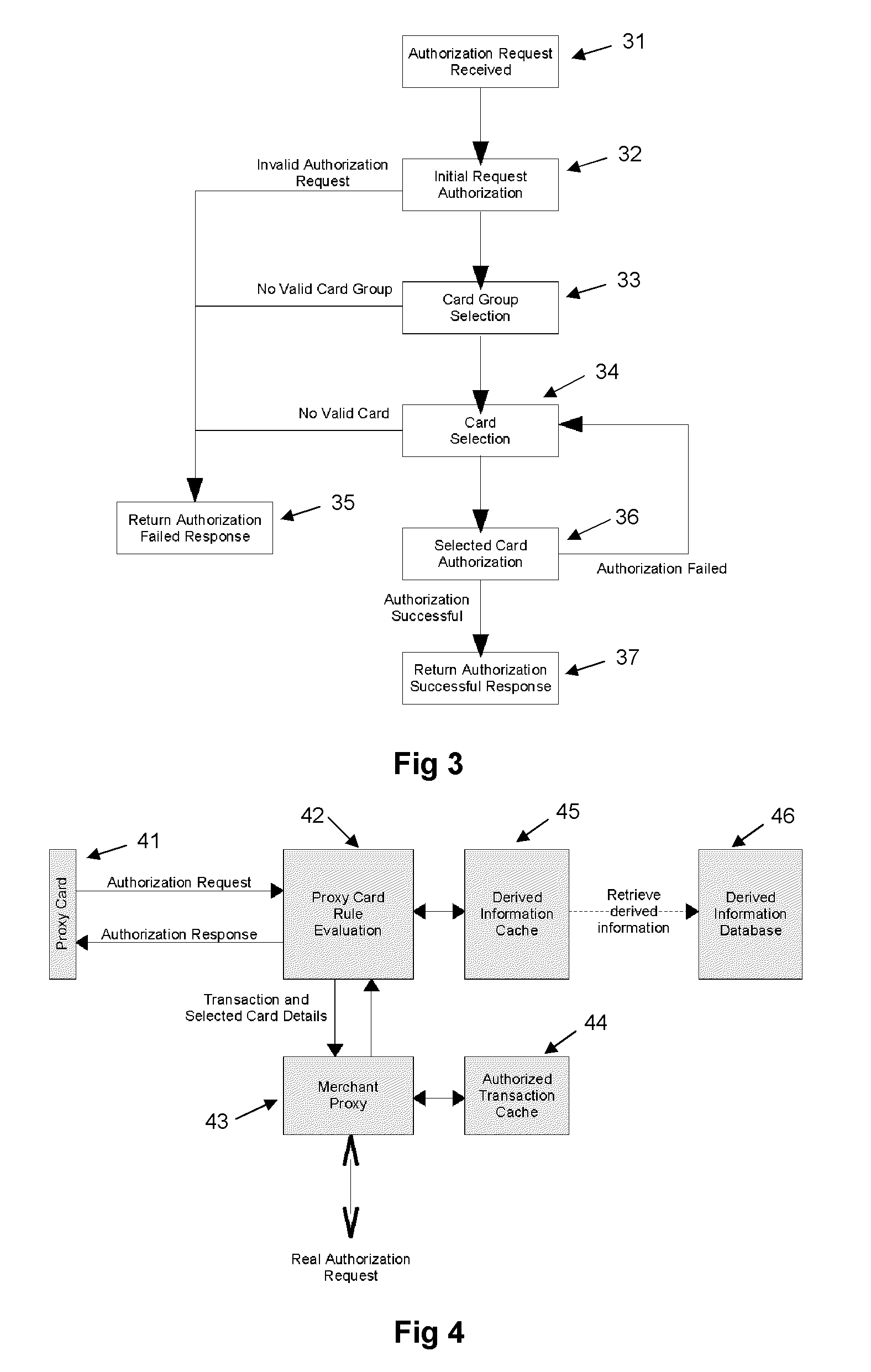

Proxy card authorization system

A system and method is provided for providing proxy access to a set of resources subject to constraints specified by the primary party having access to the resources. The system comprises one or more proxy cards associated with a proxy account that contains details on the resources available and also configurable rules for processing proxy authorization requests and returning an authorization response in dependence on the rules. The system has a particular application to payment cards and accounts, whereby the proxy card can act as proxy for one or more of the real payment cards and the proxy card authentication service may operate in a transparent manner as part of a normal overall payment authorization process.

Owner:BROWN GARY +1

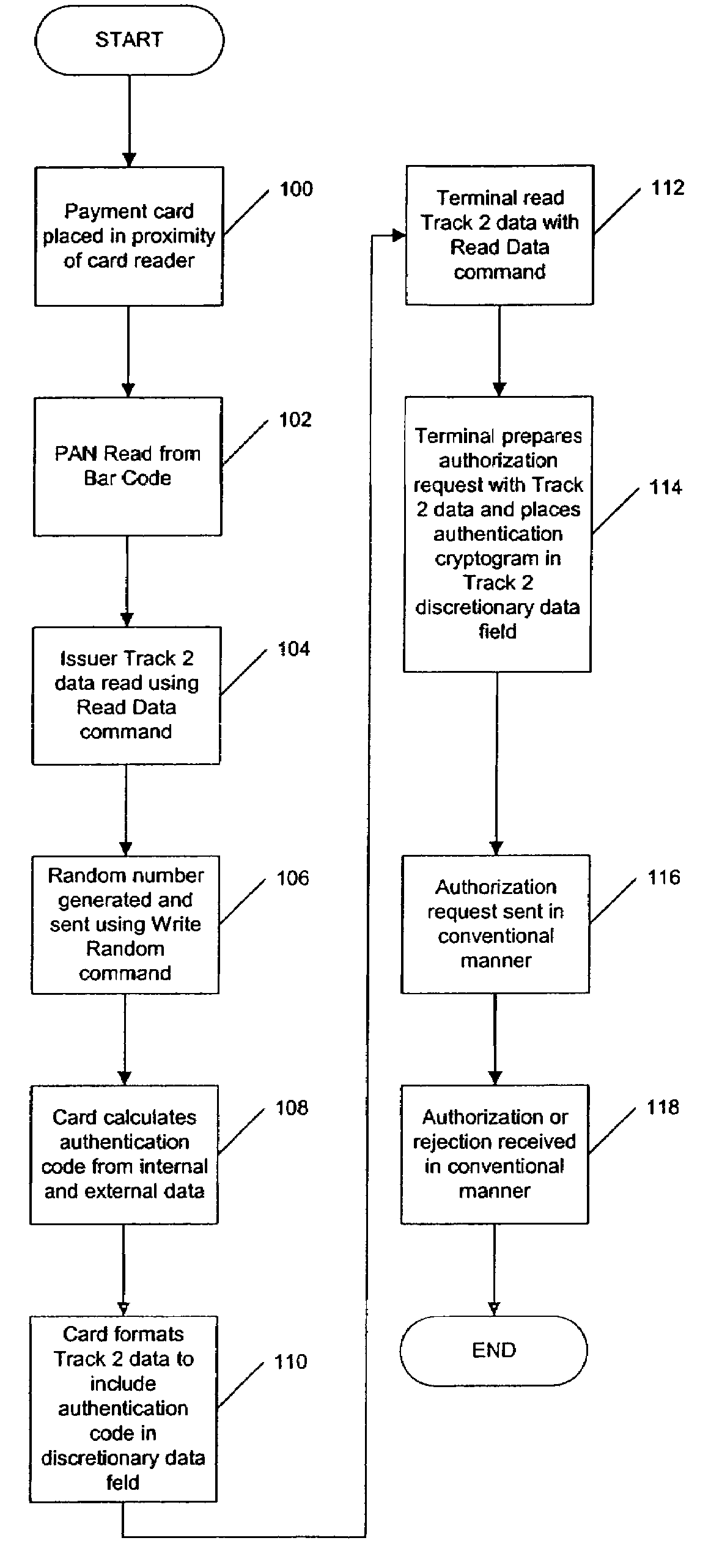

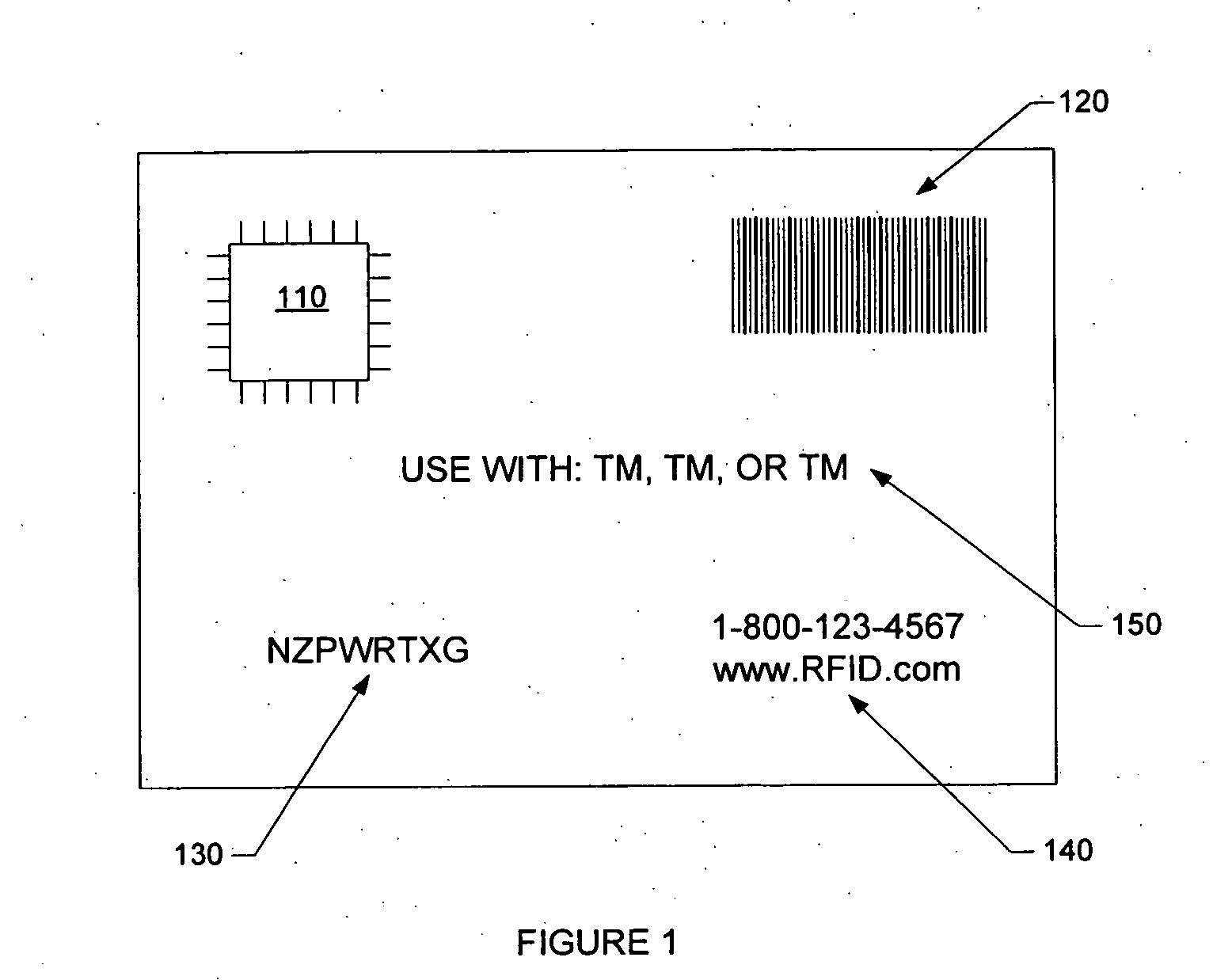

Method and system for conducting transactions using a payment card with two technologies

A system for conducting financial transactions is provided wherein payment cards have stored account information including a first portion readable by a first machine-readable technology and a second portion readable by a second different machine-readable technology. Terminals employing both of said first and second technologies are used to capture said card account information for conducting each such transaction.

Owner:MASTERCARD INT INC

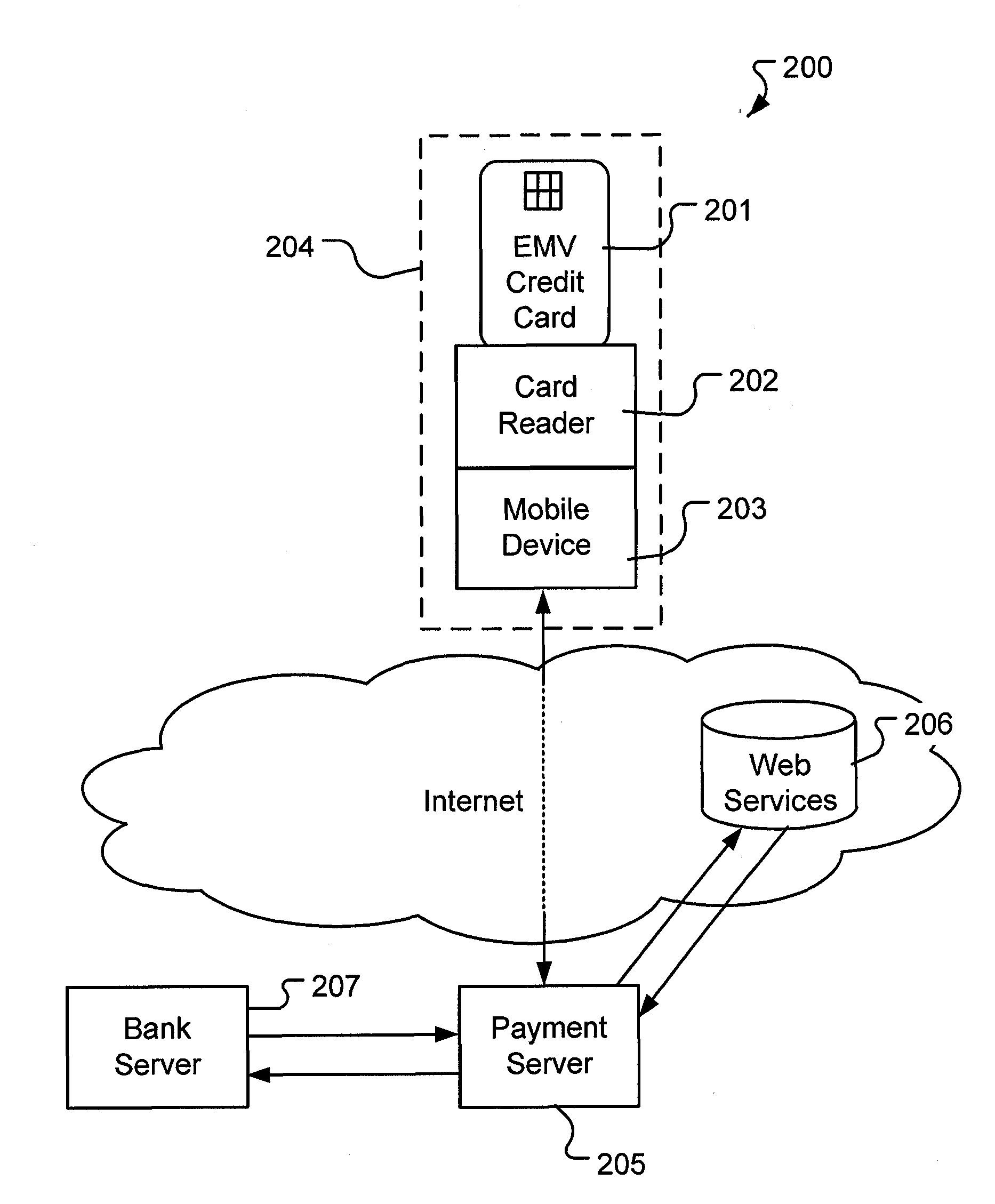

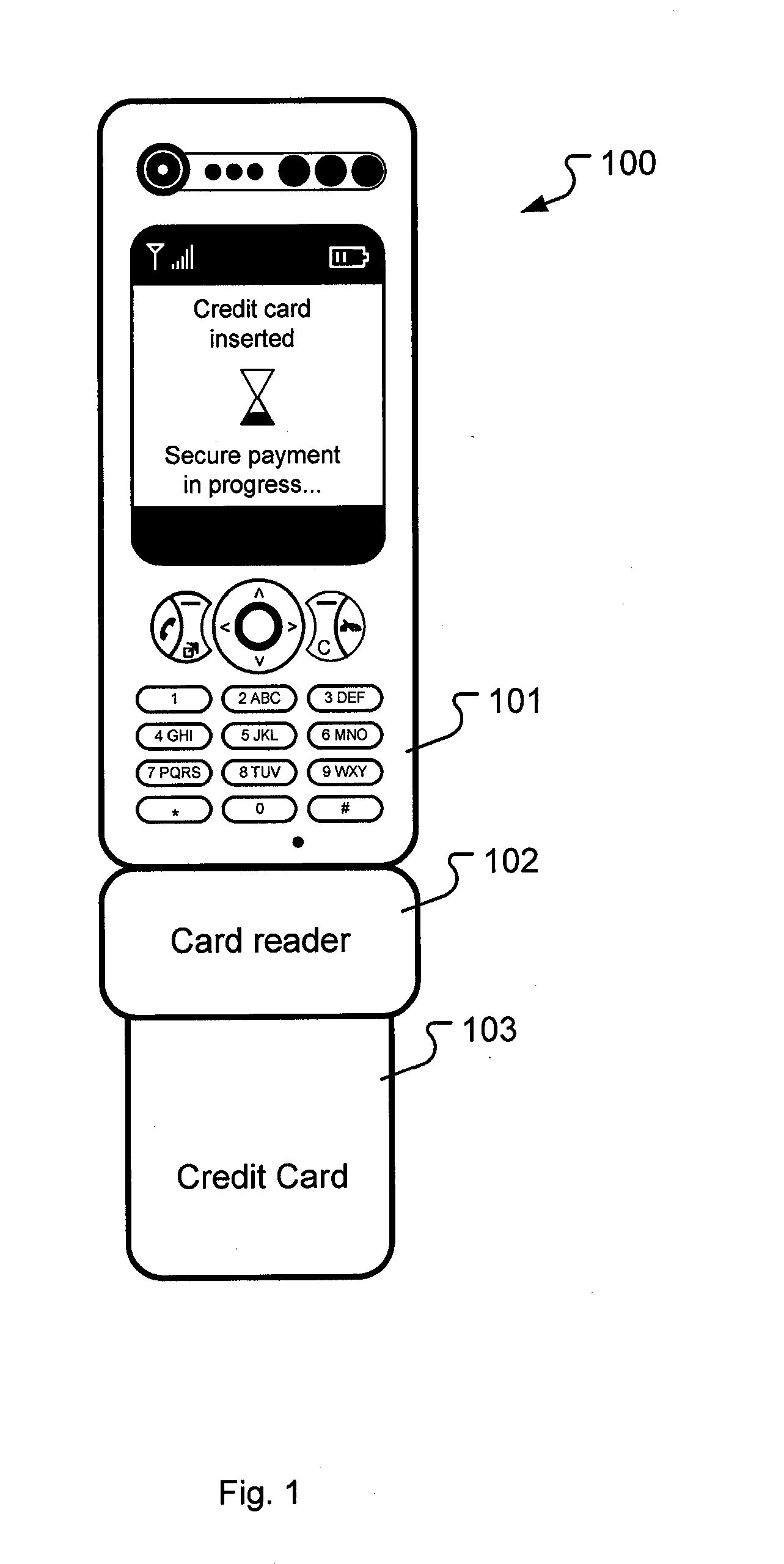

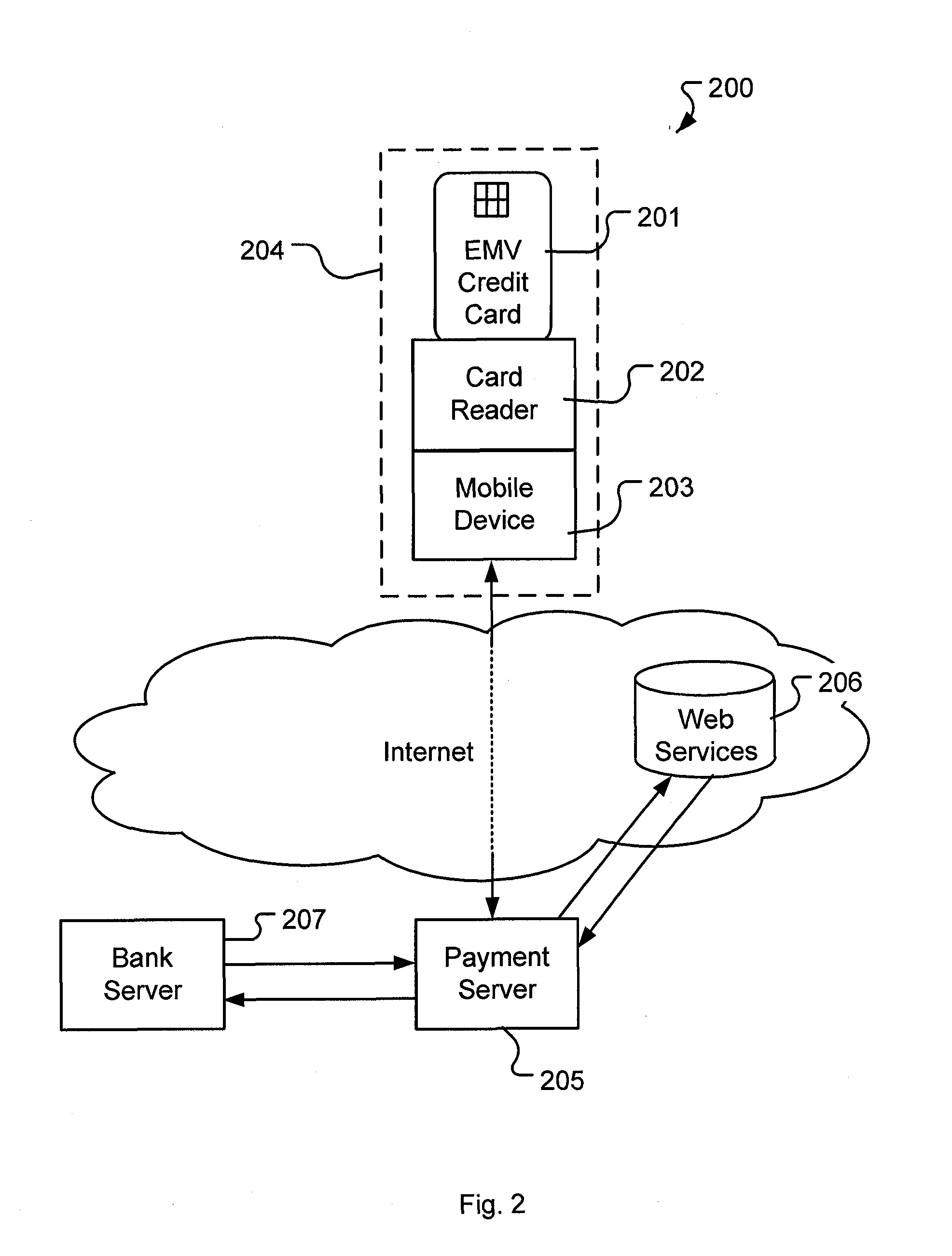

Method and system for identity and know your customer verification through credit card transactions in combination with internet based social data

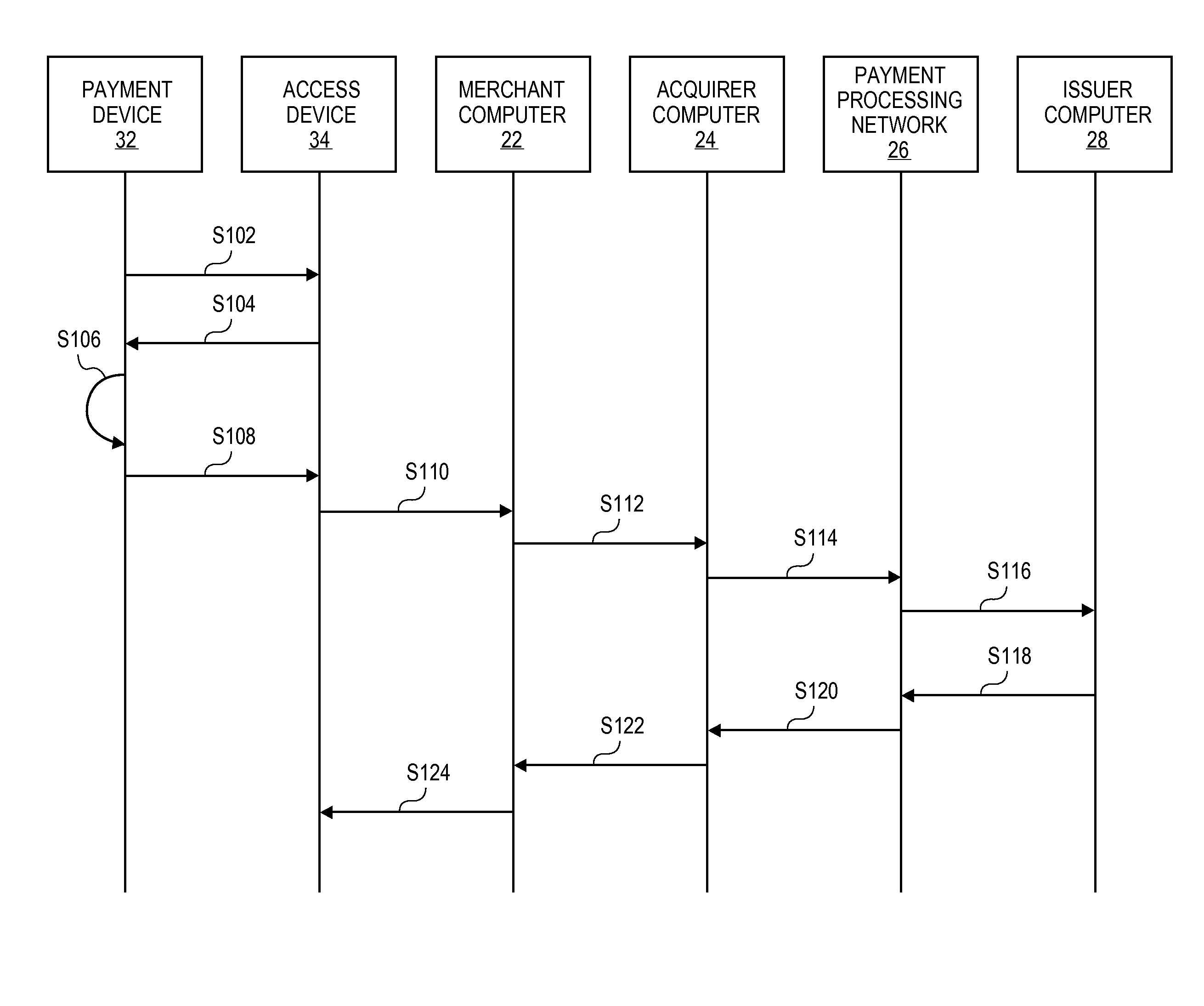

A method and system for verifying an identity of a card holder associated with a payment card using a payment device comprising a card reader and a mobile device. The method comprising the steps of initiating verification of identity of the card holder by inserting the payment card in the card reader of the payment device, reading card information from the payment card communicating the card information from the mobile device to a payment server, comparing received card information with stored card information in the payment server and accessing at least one web service. The account activity is analysed in the at least one web service and in that way verifying that the identity of the card holder is the same as the identity associated with the payment card, based on the analysis of information from the at least one web service and from the comparison of card information with stored card information. Terminating the verification process by communicating the result of the verification process from the payment server to the payment device.

Owner:IZETTLE MERCHANT SERVICES

Payment card with dynamic account number

ActiveUS8494959B2Avoid processing delaysOvercomes drawbackAcutation objectsFinanceDisplay devicePayment order

A payment card comprises a processor, a trigger source coupled to the processor, and a display for outputting at least a portion of a dynamic account number under control of the processor responsive to the trigger source. The dynamic account number is determined based at least in part on a seed stored in the payment card and an output of the trigger source. In an illustrative embodiment, the dynamic account number is generated utilizing a time-based or event-based one-time password algorithm. For example, in a time-based embodiment, the trigger source may comprise a time of day clock, with the dynamic account number being determined based at least in part on the seed and a current value of the time of day clock. In an event-based embodiment, the trigger source may comprise an event counter, with the dynamic account number being determined based at least in part on the seed and a current value of the event counter.

Owner:EMC IP HLDG CO LLC

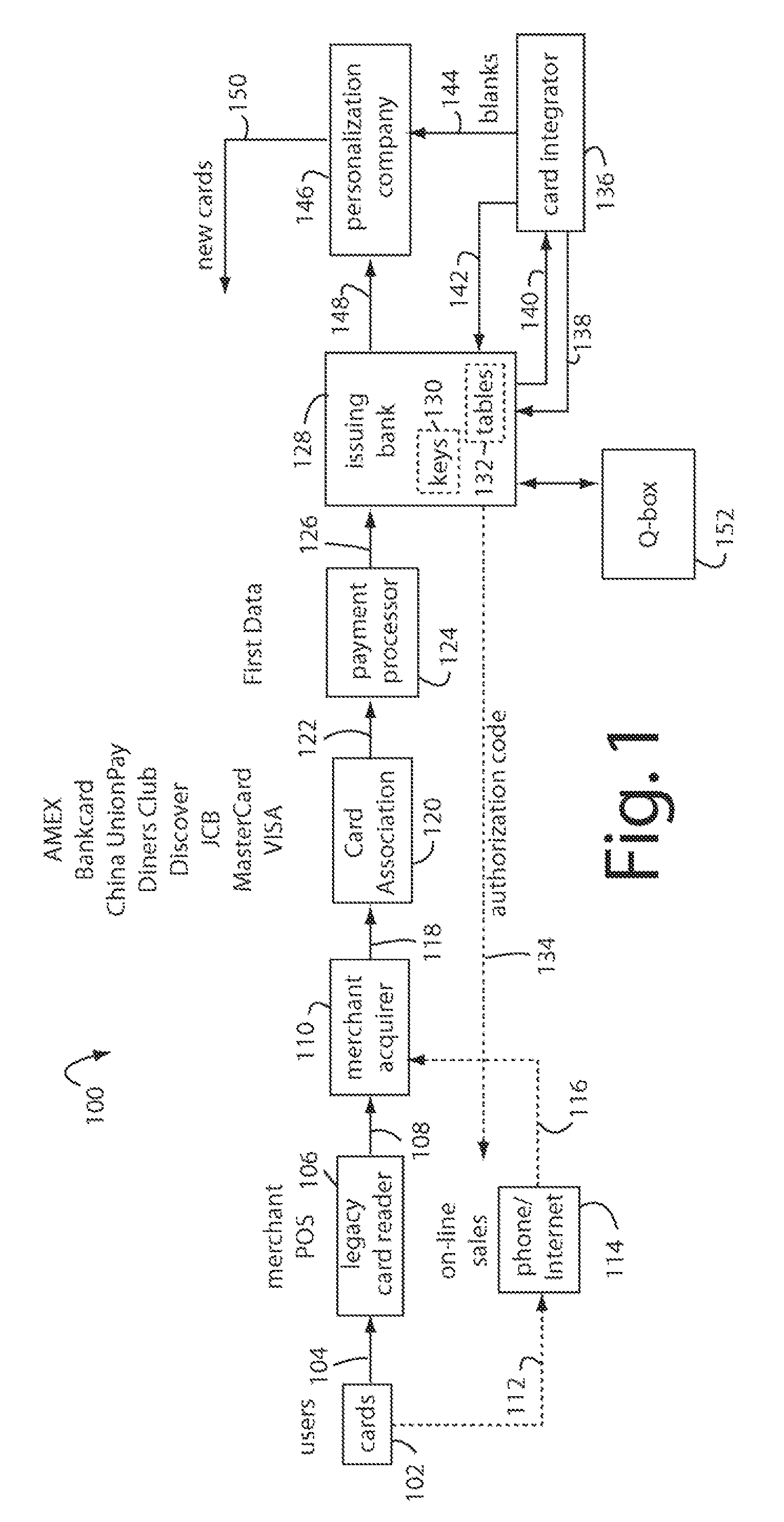

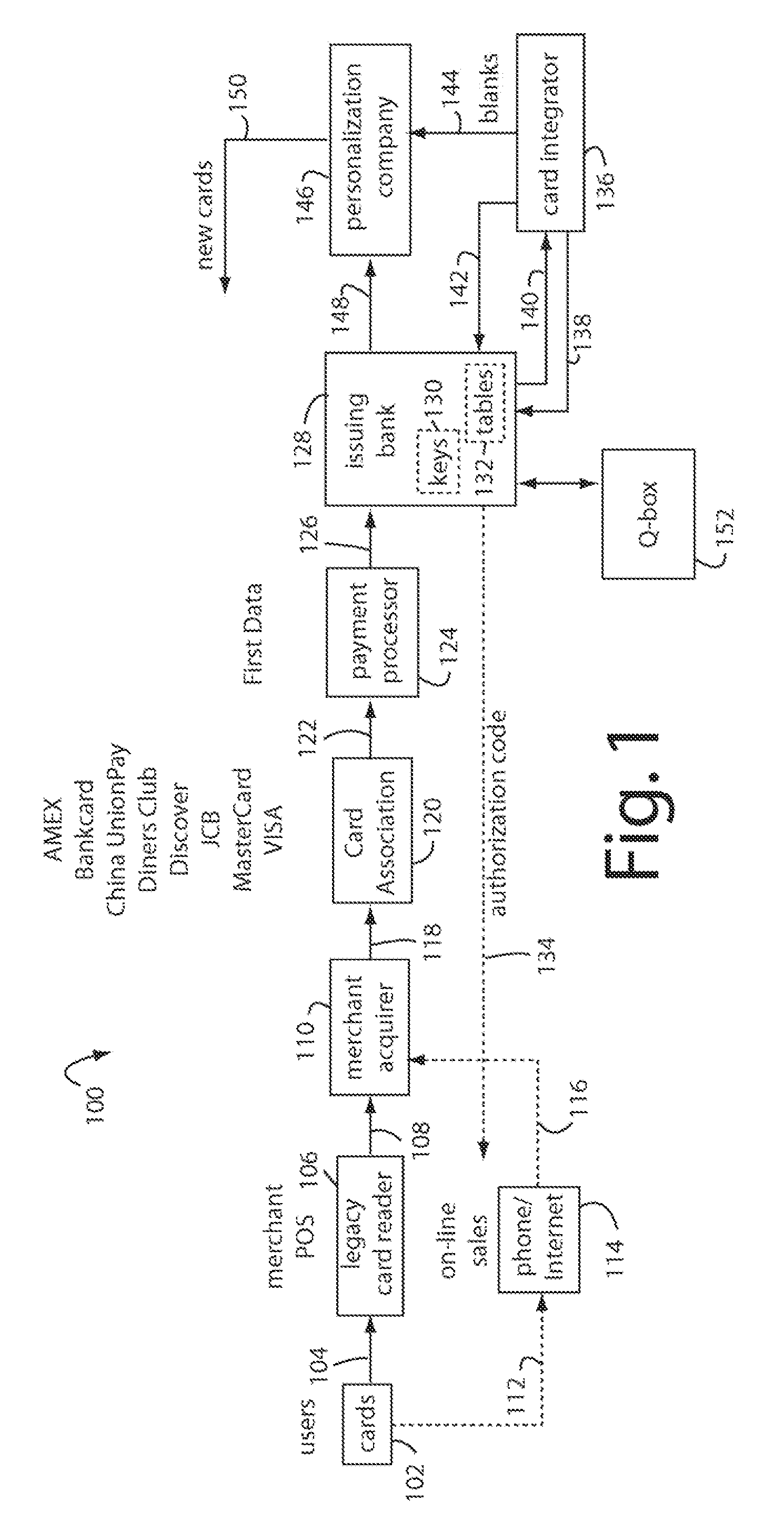

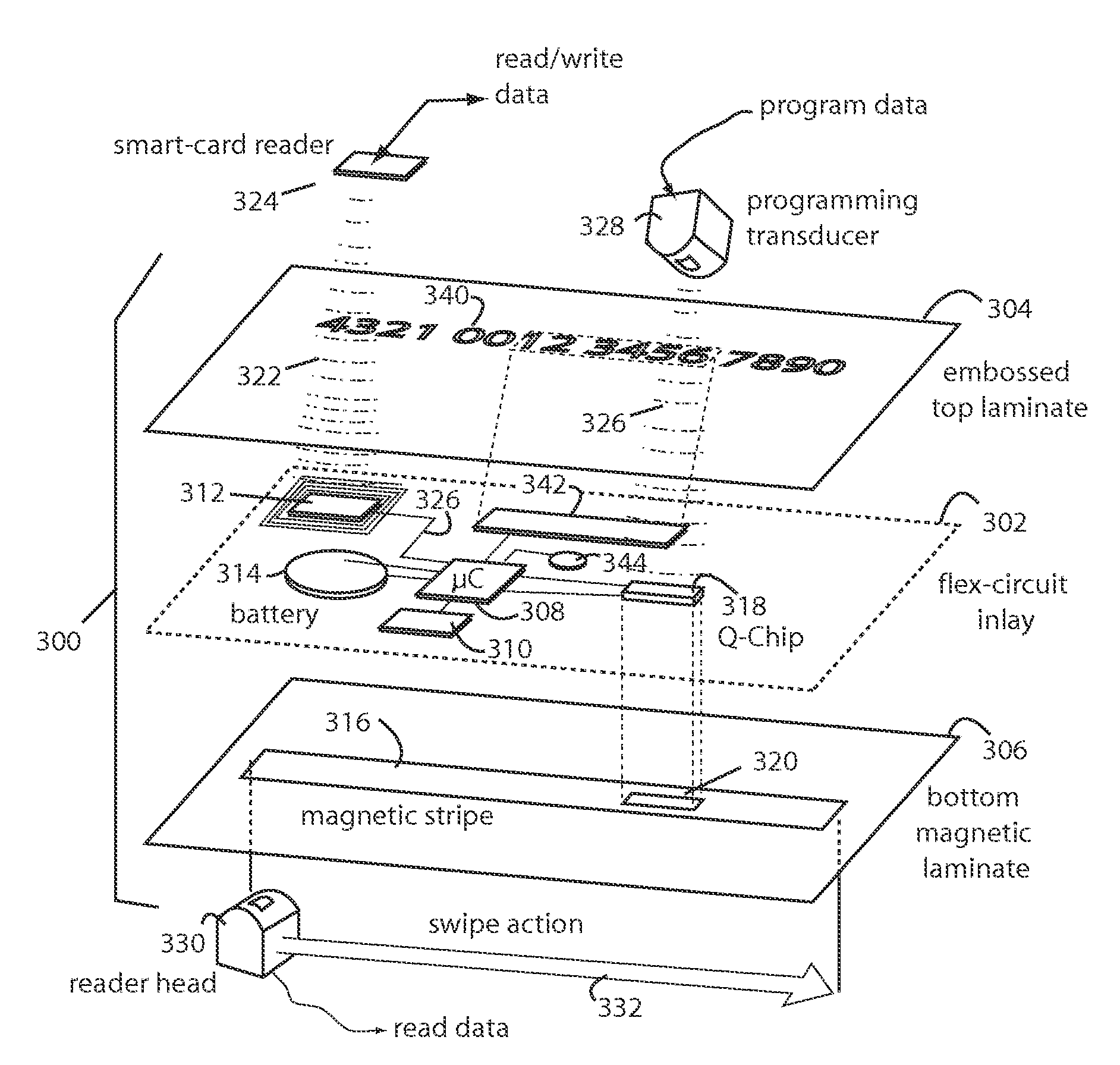

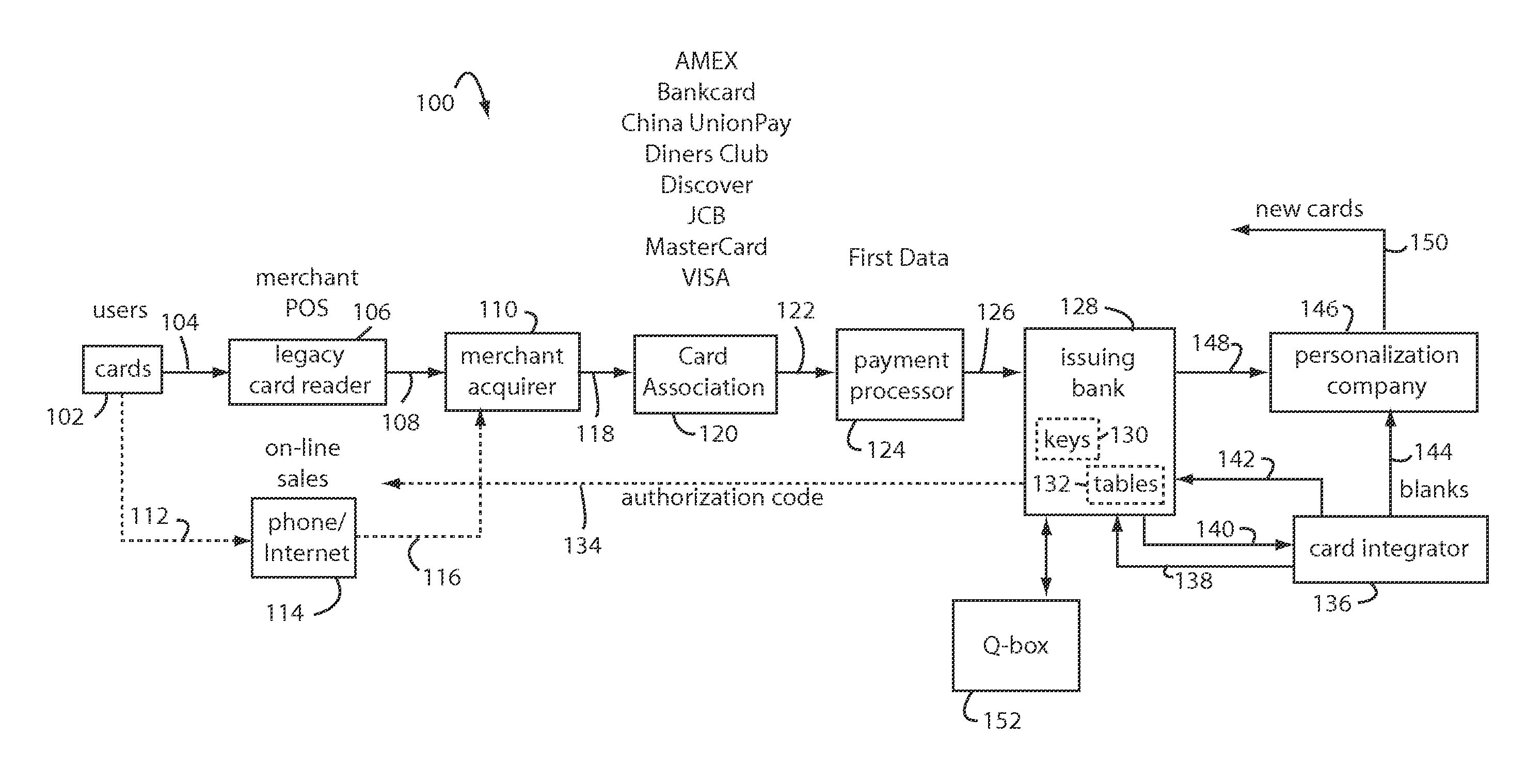

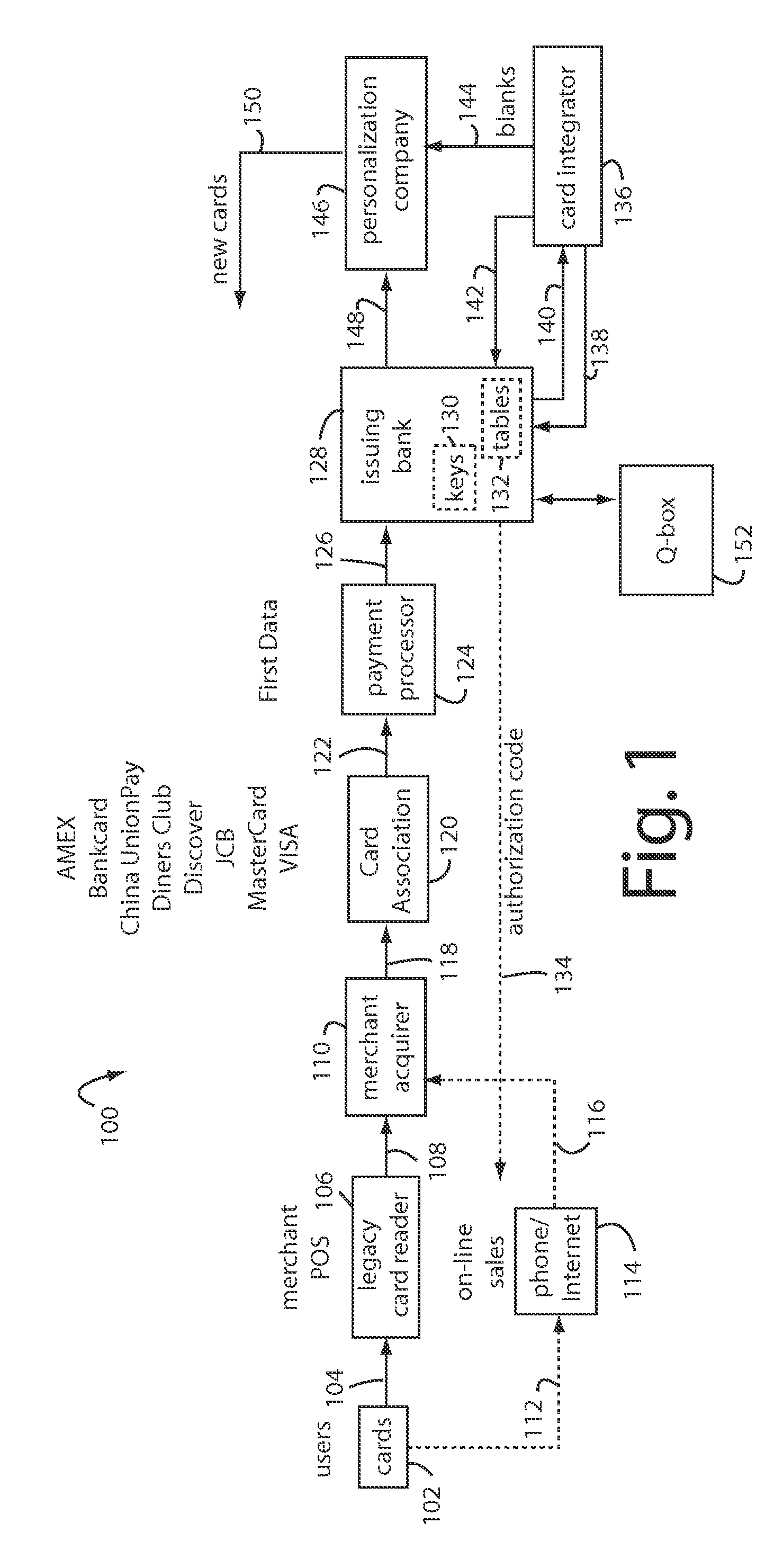

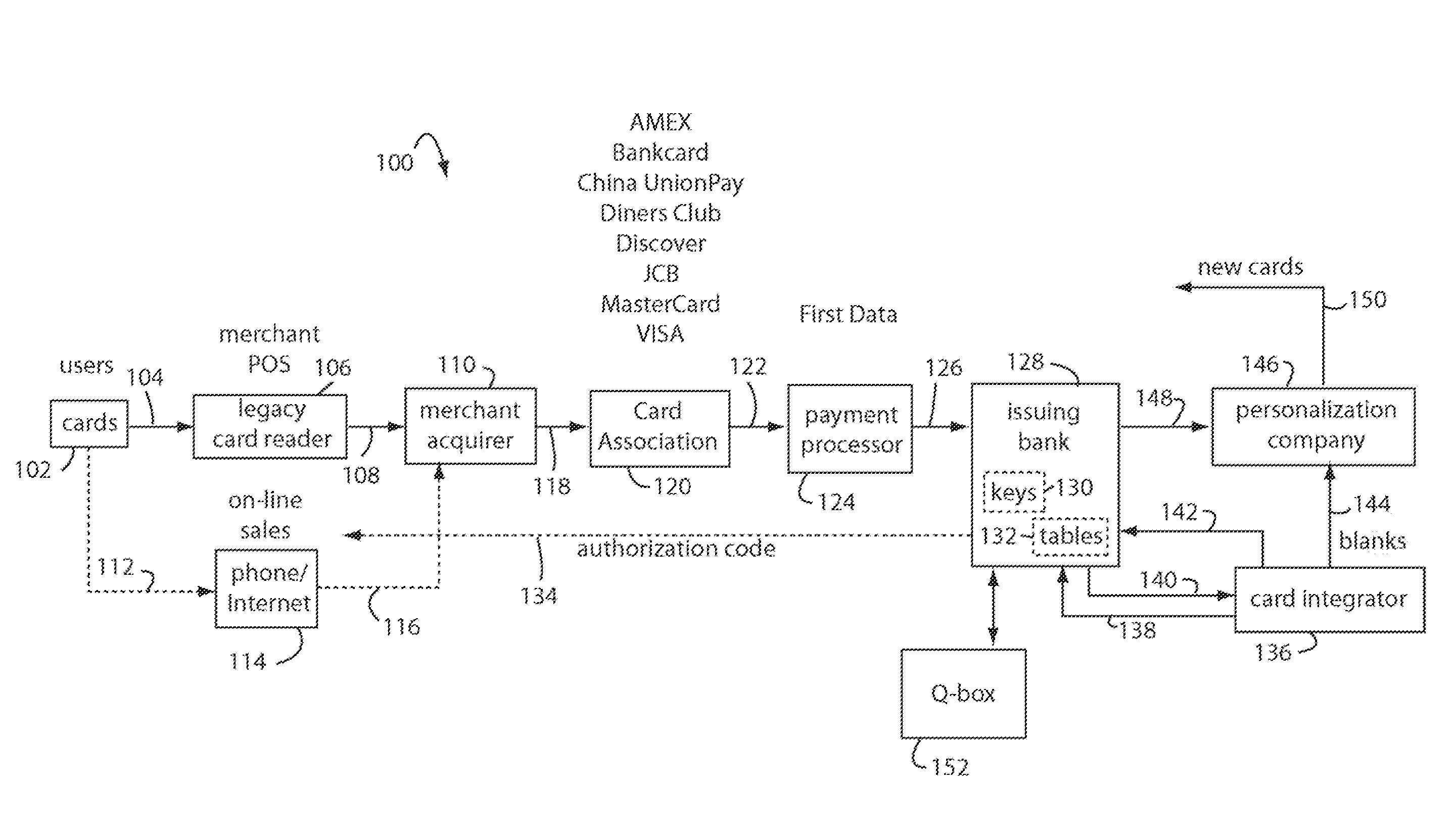

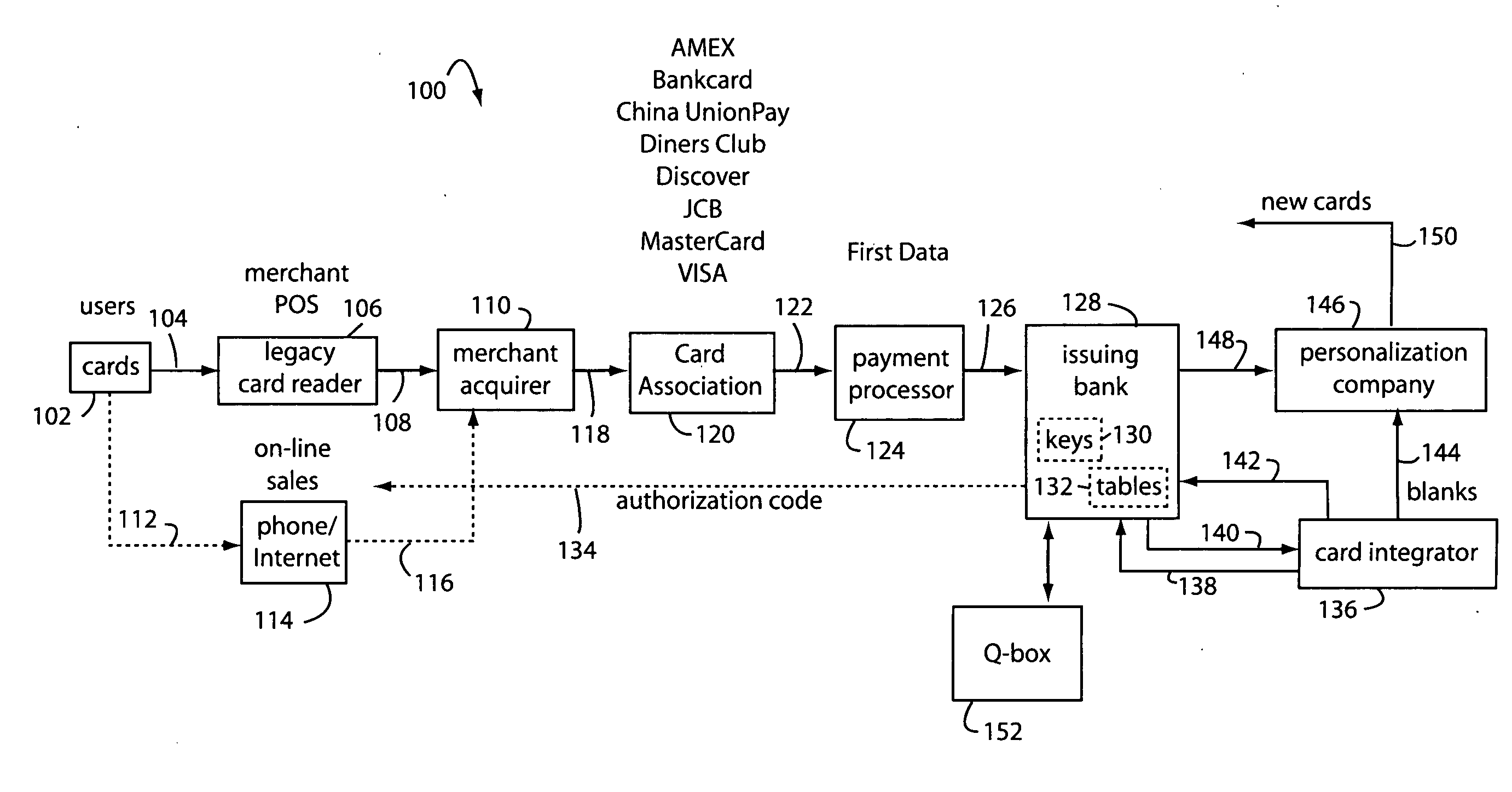

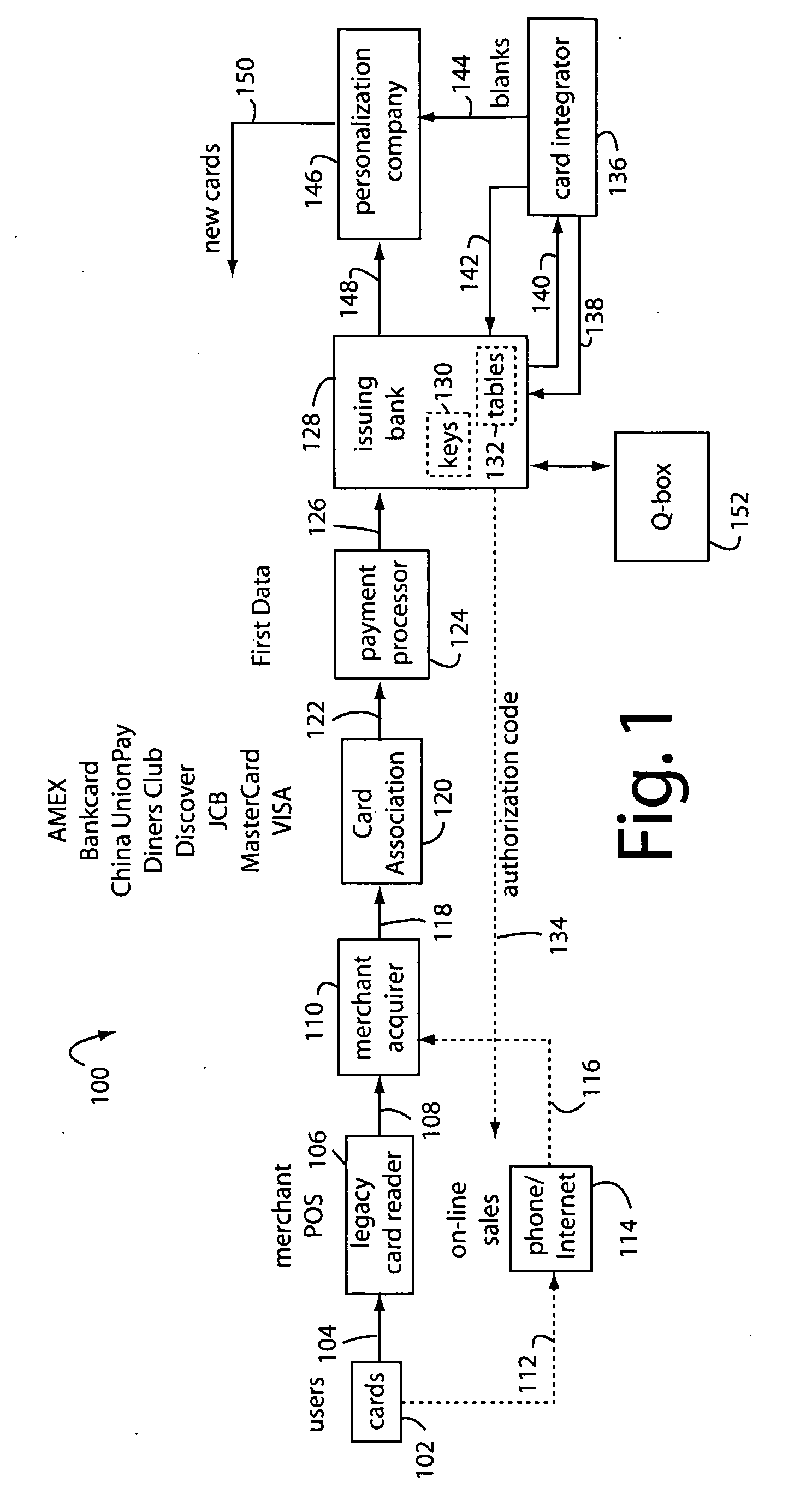

Financial transaction network

The manufacture and control of payment cards used in consumer financial transactions circulates a population of payments cards with user identification and account access codes. Each use of an individual card produces a variation of its user access code according to an encryption program seeded with encryption keys or initialization vectors. A portion of the magnetic stripe is made dynamic with a Q-Chip magnetic MEMS device. The job of personalizing payment cards with the user identification and account access codes is outsourced to a personalization company. The encryption keys and initialization vectors are kept private from the personalization company by using the encryption program to generate tables of computed results. Respective ones of the tables of computed results are sent for loading by the personalization company into new members of the population of payments cards. New payment cards are manufactured and distributed that include and operate with the tables of computed results.

Owner:FITBIT INC

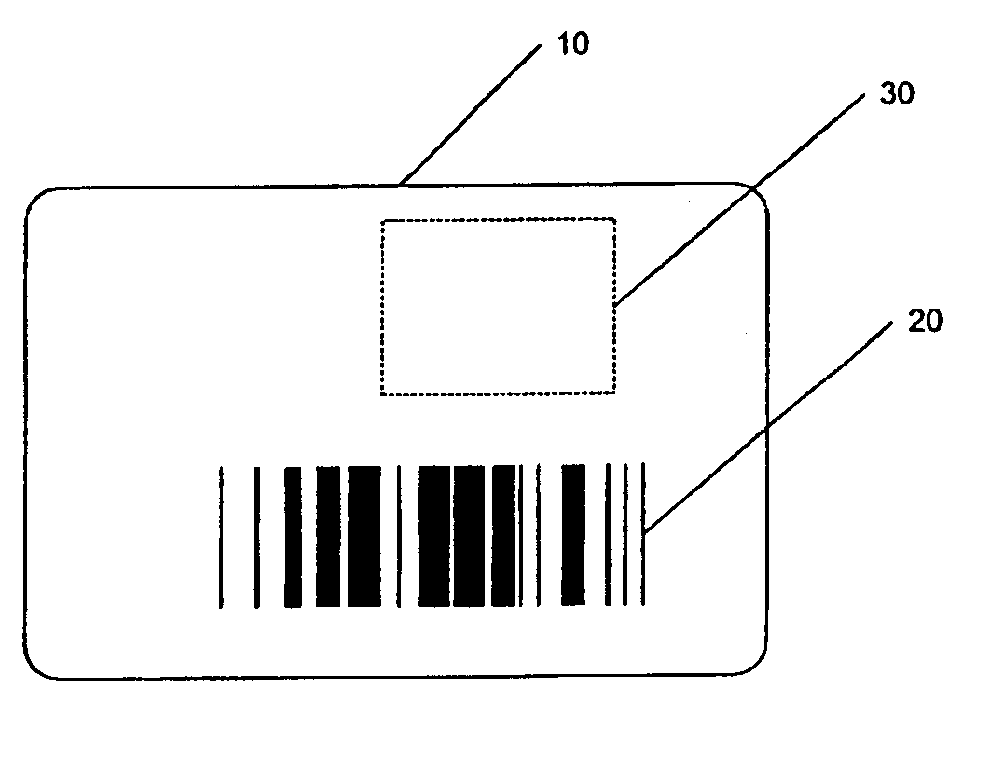

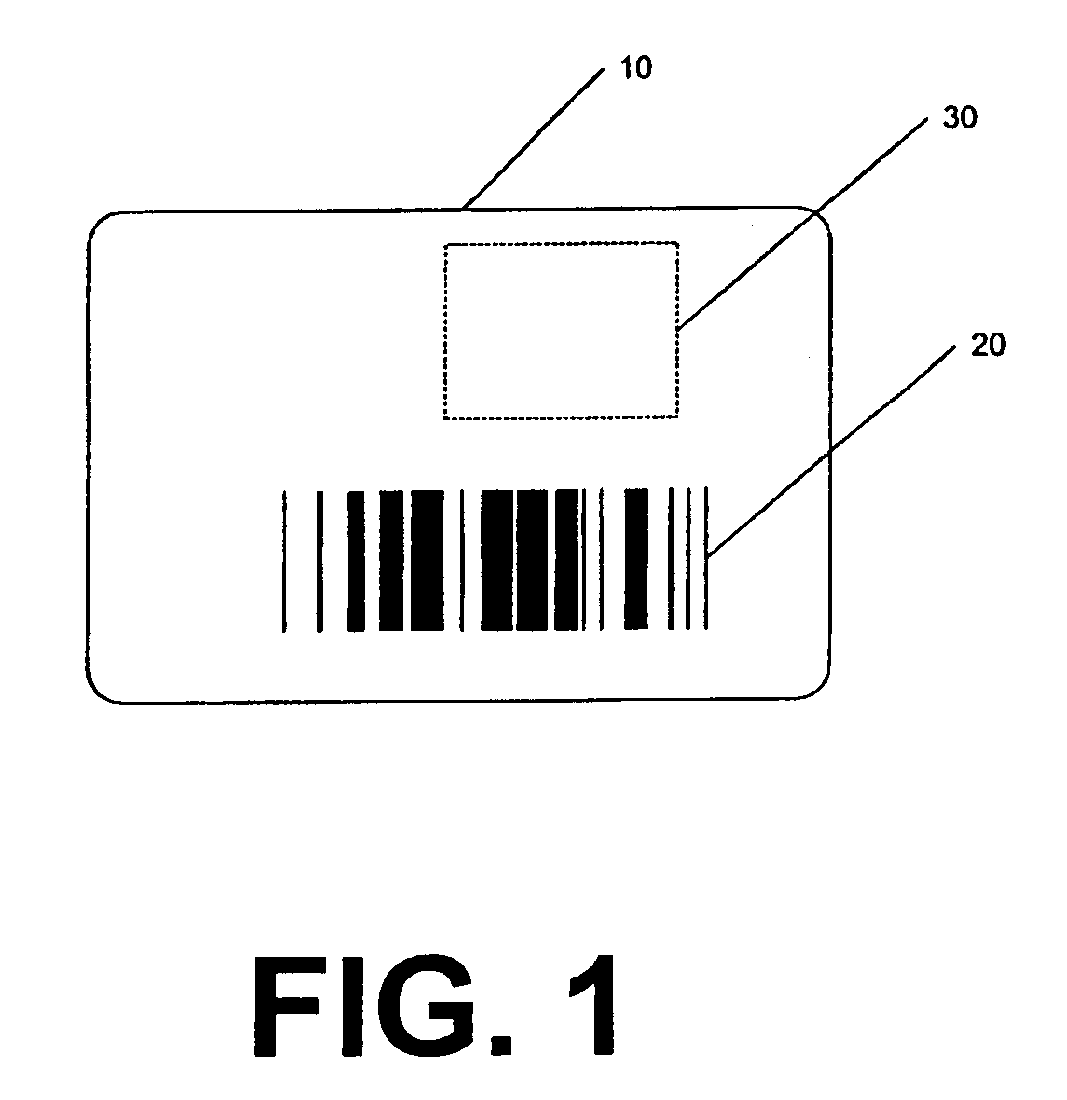

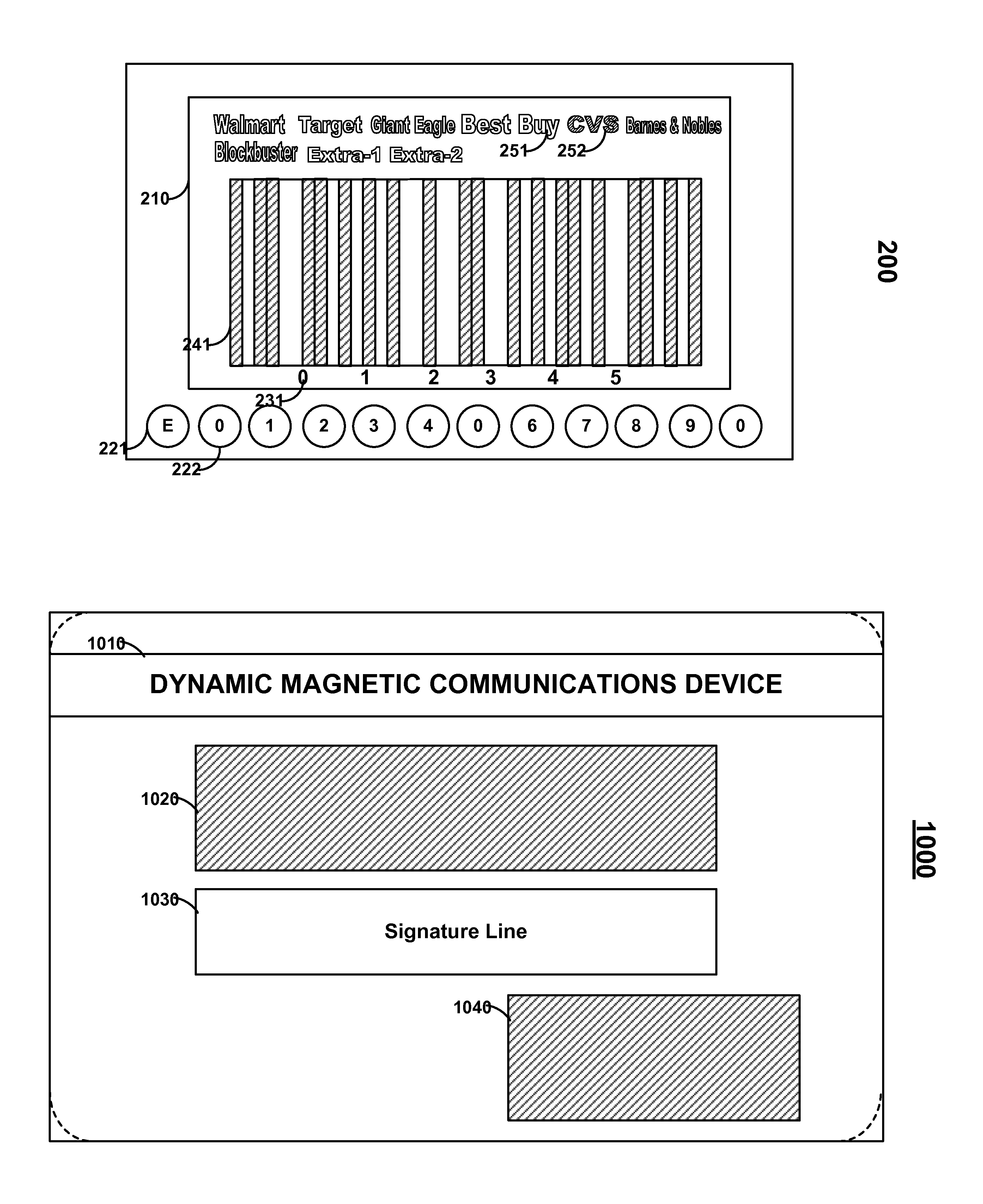

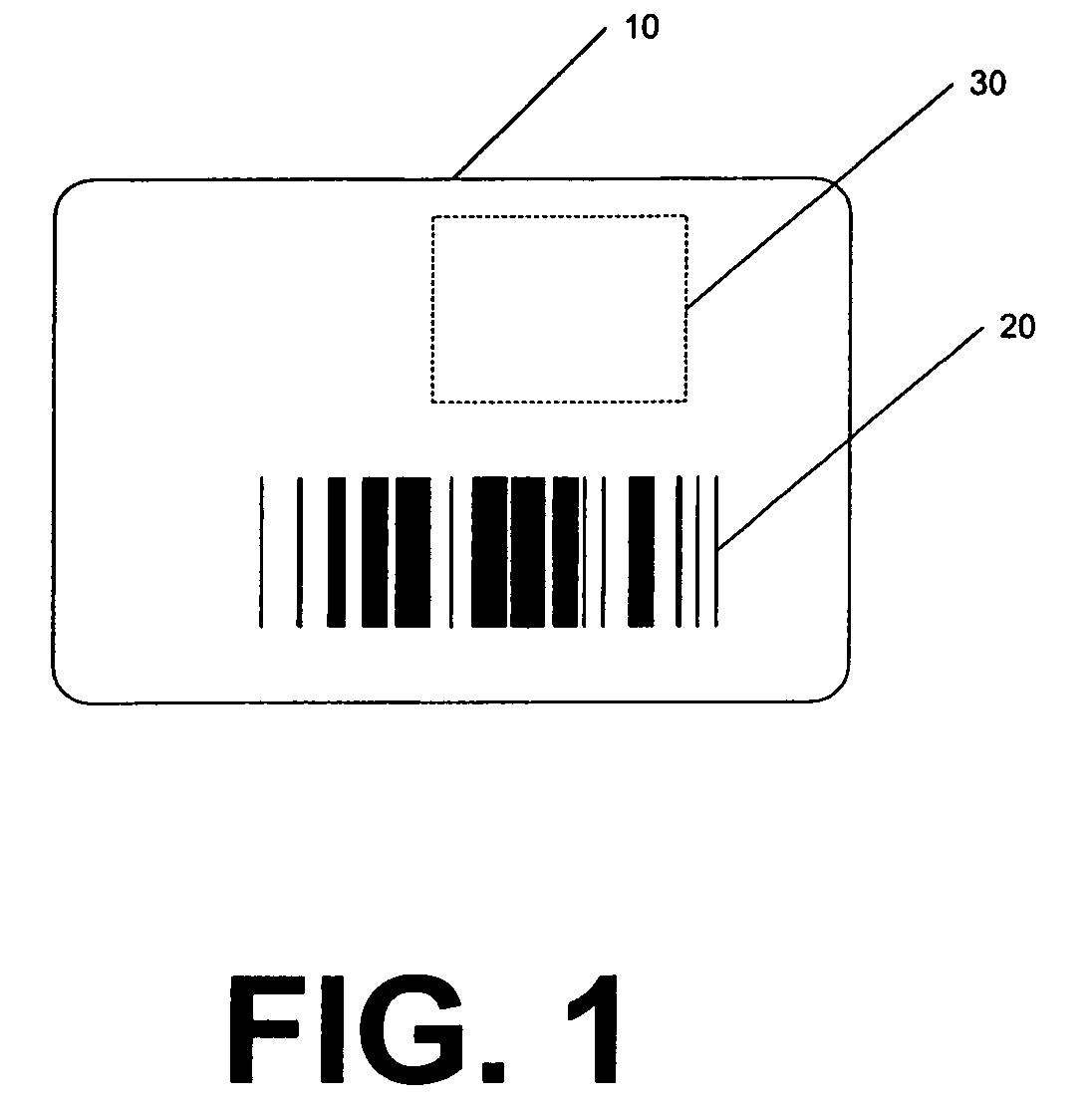

Payment cards and devices for displaying barcodes

ActiveUS8931703B1Avoid excessive errorExtraction of informationAcutation objectsRecord carriers used with machinesDisplay deviceBarcode

A payment card is provided with a display. A barcode may be selectively displayed on the display. A display may be an electrochromic display in order to increase the readability of a displayed barcode with respect to computer vision equipment. A barcode may be selected by a user from a set of barcodes. Each barcode in a set of barcodes may correspond to a different loyalty account for a different merchant. Accordingly, a user can carry a single card—but may be able to communicate multiple loyalty account barcodes to computer vision equipment across multiple merchants.

Owner:DYNAMICS

Contact/contactless and magnetic-stripe data collaboration in a payment card

InactiveUS20060287964A1Reduce loss due to fraudDebit schemesMarketingComputer hardwareData collaboration

A method of providing a magnetic-stripe type payment card with coupons and micropayment authorizations provides an internal link on a payment card between a contact / contactless processor and a MEMS magnetic device. This communicates information received from a contact / contactless payments infrastructure to be presented to a magnetic stripe payments infrastructure as specially recorded data bits written by the MEMS magnetic device in a magnetic stripe track.

Owner:FITBIT INC

Payment card processing system

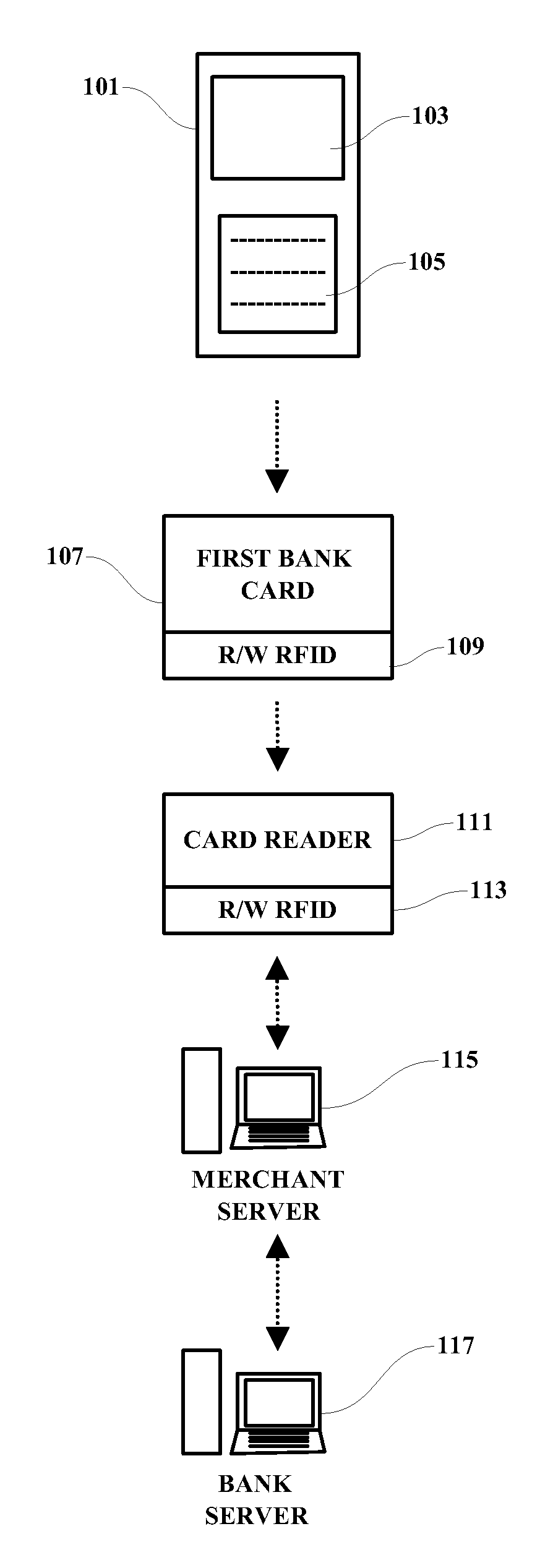

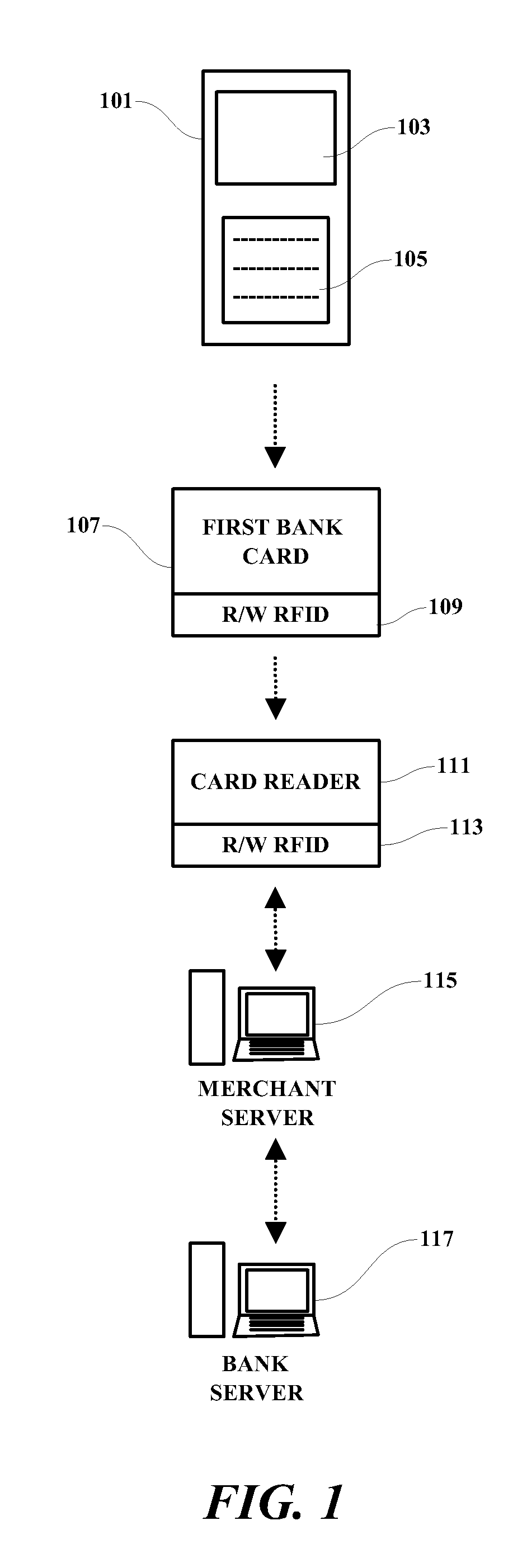

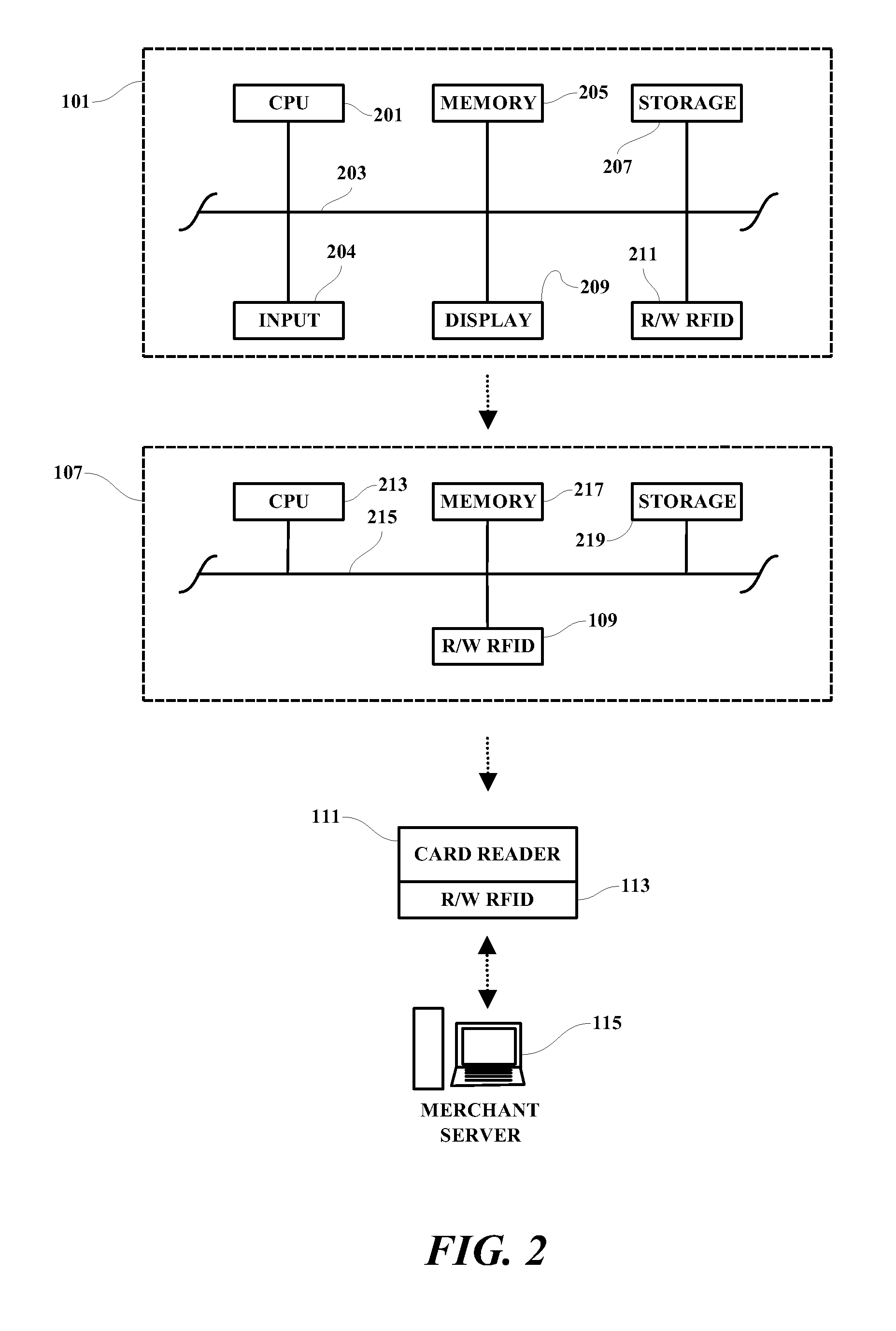

A method, programmed medium and system are provided for using a payment card with an embedded RFID device. In one example, a cellular telephone or other wireless device is used to generate a one-time password (OTP), which is then transmitted by a read-write RFID in the wireless device to the read-write RFID which is embedded within a payment card. The user's phone or other wireless device then activates the writing of the OTP to the RFID of the payment card. The payment card, with the one time password now saved in the card, is then handed to the waiter or store clerk for payment approval and / or further processing. The user's OTP is then read by the merchant's RFID reader and transmitted to an approving agency / server for approval or disapproval of the user's purchase.

Owner:IBM CORP

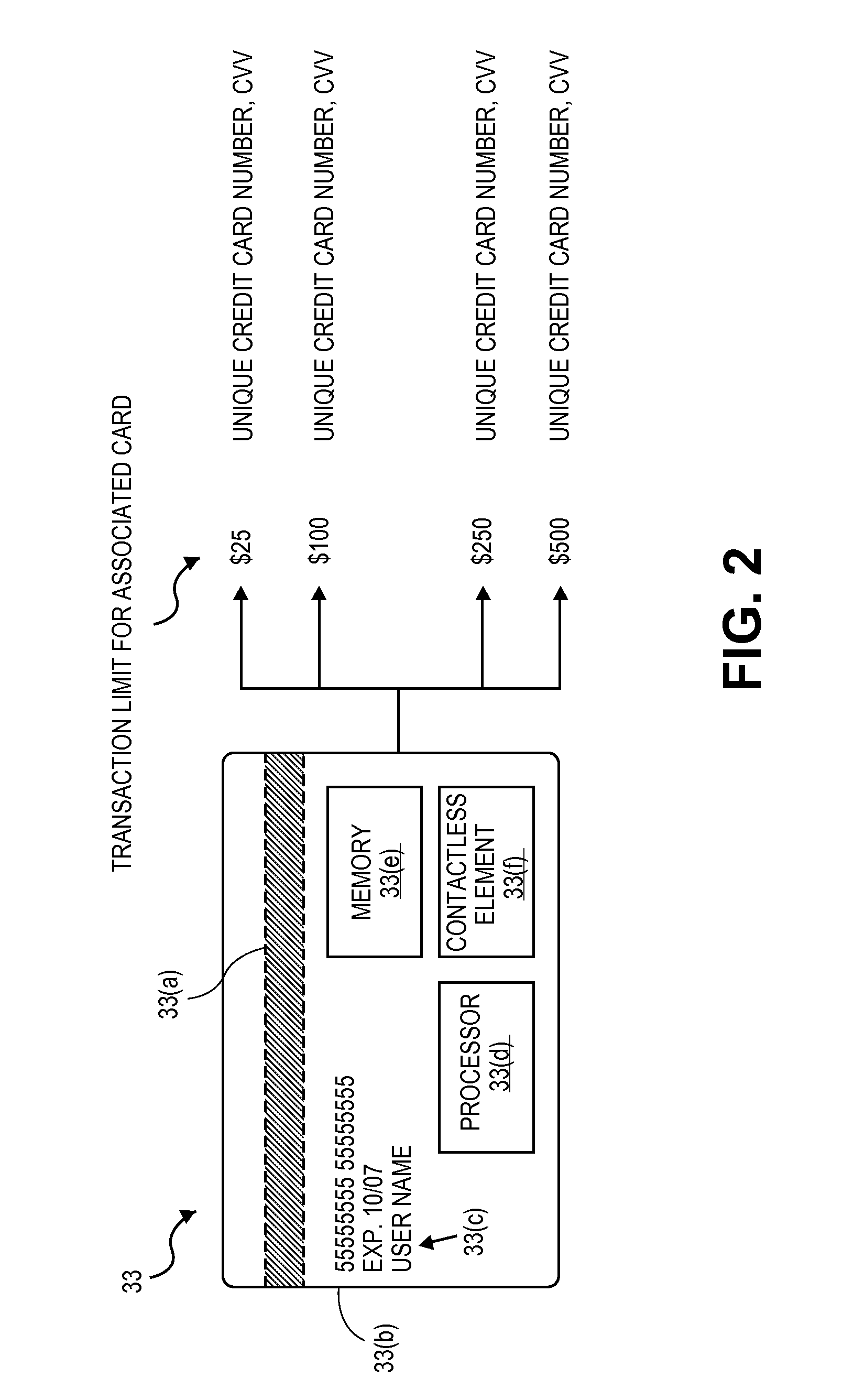

Dynamic Account Selection

Embodiments automatically select one of the multiple pre-generated payment cards provisioned on a mobile device. The multiple pre-generated payment cards (real or virtual) may each have a different credit limit. The mobile device may automatically select one of the multiple payment cards based on a transaction value of a transaction that is being conducted. An available credit limit of the selected payment card may be equal to or slightly greater than the transaction value. In some embodiments, the available credit limit of the selected payment card may be closer to the transaction value than the available credit limits of the remaining payment cards. In some embodiments, the different payment cards may be provisioned in a chip-and-pin based smart credit card or mobile wallet.

Owner:VISA INT SERVICE ASSOC

Method and system for conducting transactions using a payment card with two technologies

A system for conducting financial transactions is provided wherein payment cards have stored account information including a first portion readable by a first machine-readable technology and a second portion readable by a second different machine-readable technology. Terminals employing both of said first and second technologies are used to capture said card account information for conducting each such transaction.

Owner:MASTERCARD INT INC

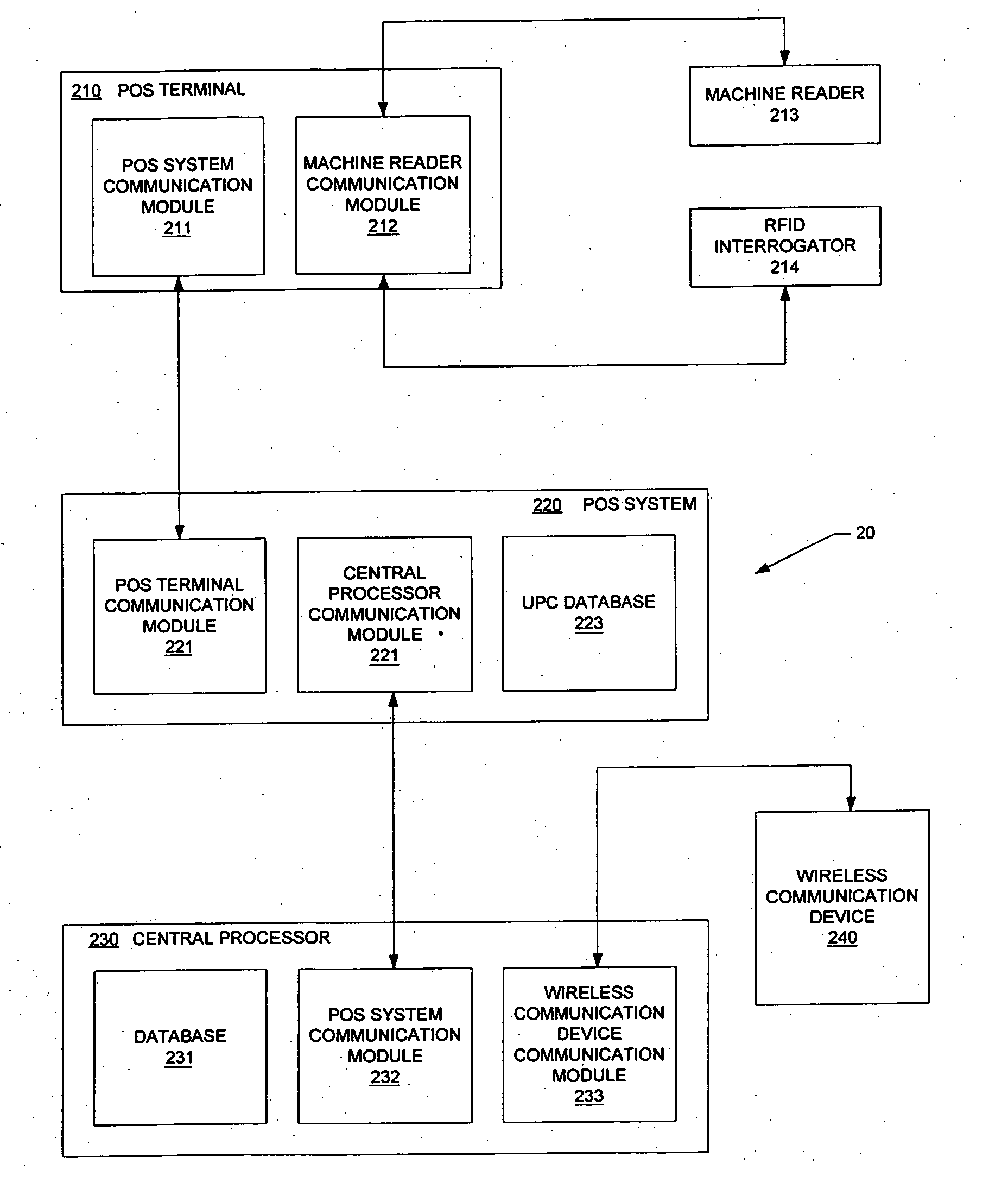

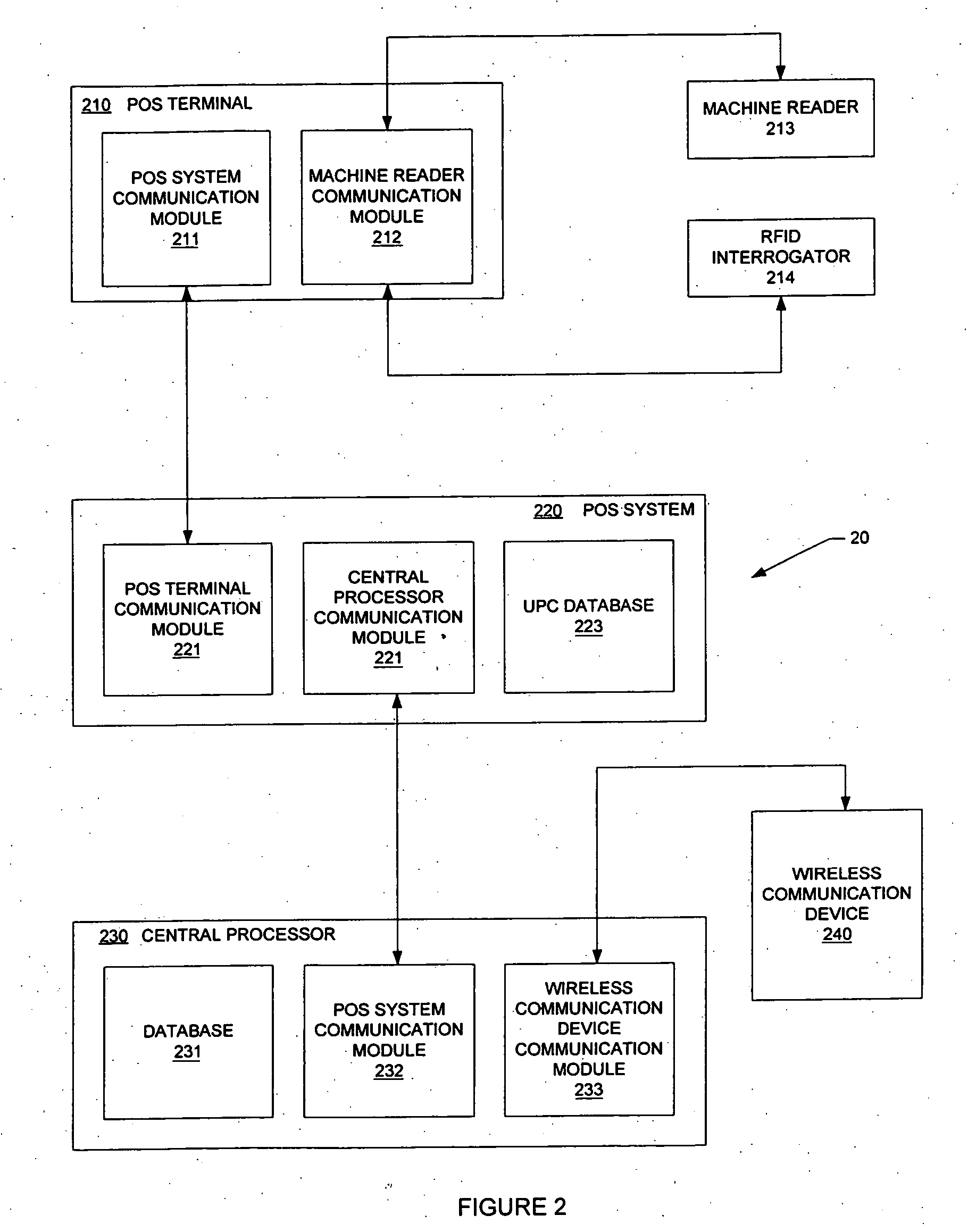

Radio frequency identification purchase transactions

Methods and systems for using a Radio Frequency Identification (RFID) payment card are disclosed herein. The method generally comprises receiving an indicia identifying an RFID card, receiving a request to activate the RFID card, activating the RFID card by associating an initial value with a database record associated with the RFID card; receiving a PIN associated with the RFID card; receiving profile information; and associating the profile information with the database record. Systems for using RFID cards generally comprise an RFID card, an RFID account associated with the RFID card, a merchant communication module that receives indicia identifying the RFID card and sends a request to activate the RFID card, and a central processor or intermediary that receives a PIN associated with the RFID card and a request to activate the RFID card from the merchant communication module.

Owner:E2INTERAVTIVE INC

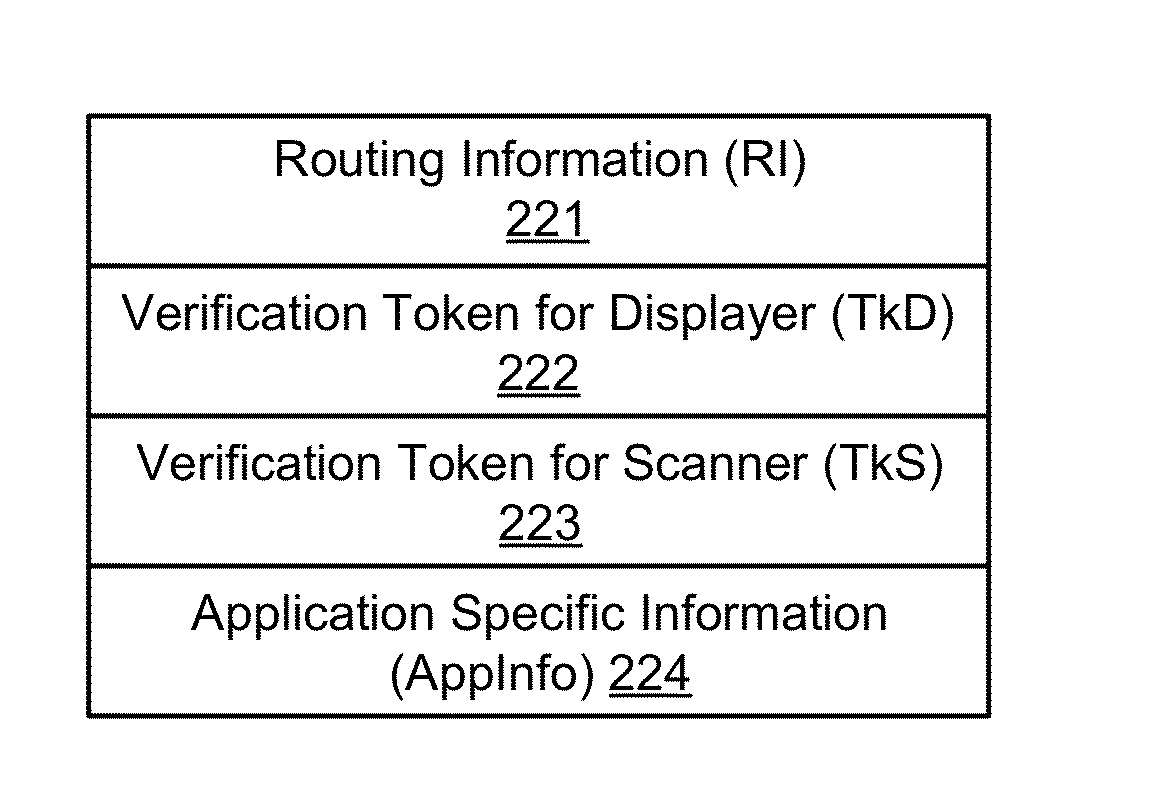

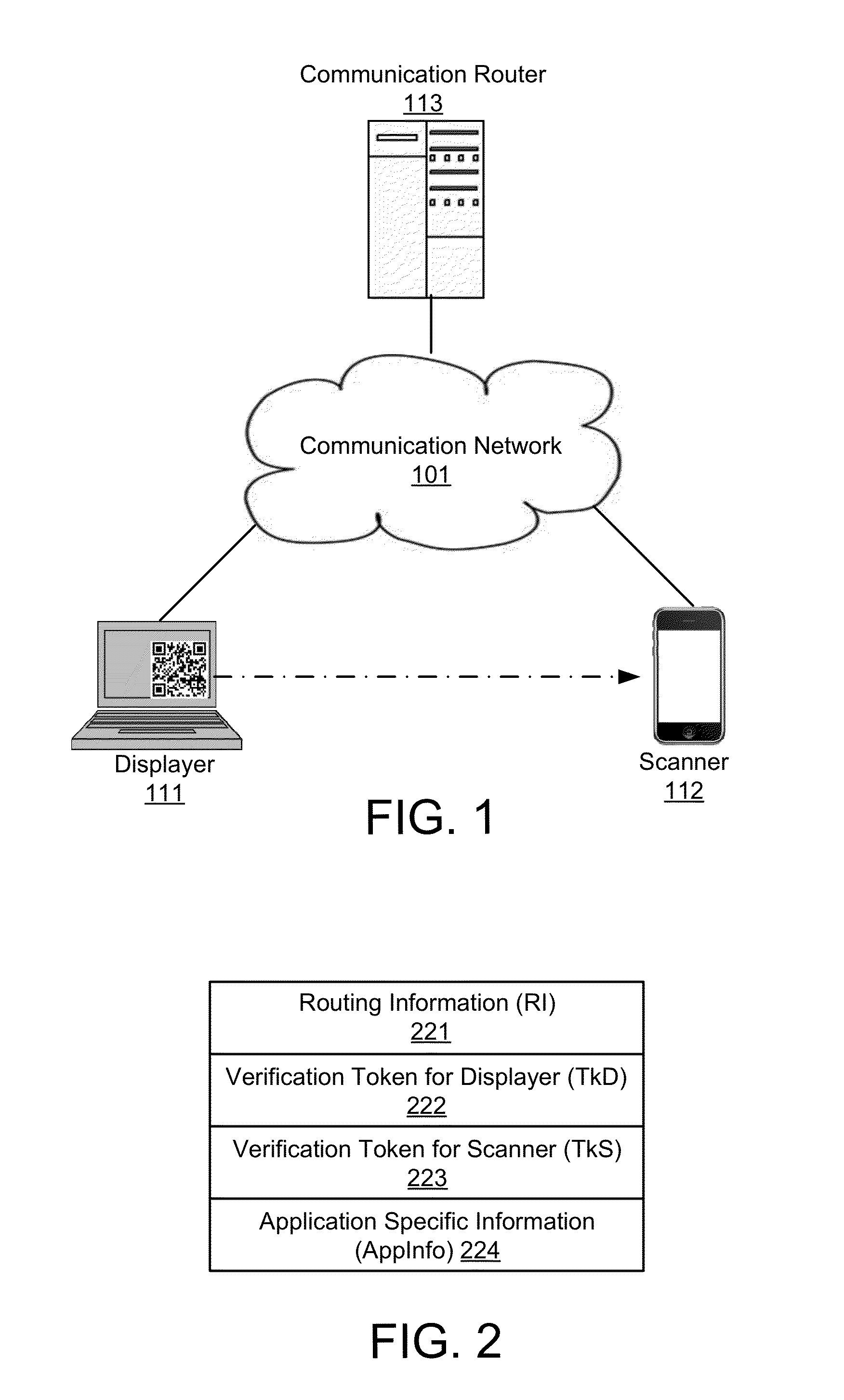

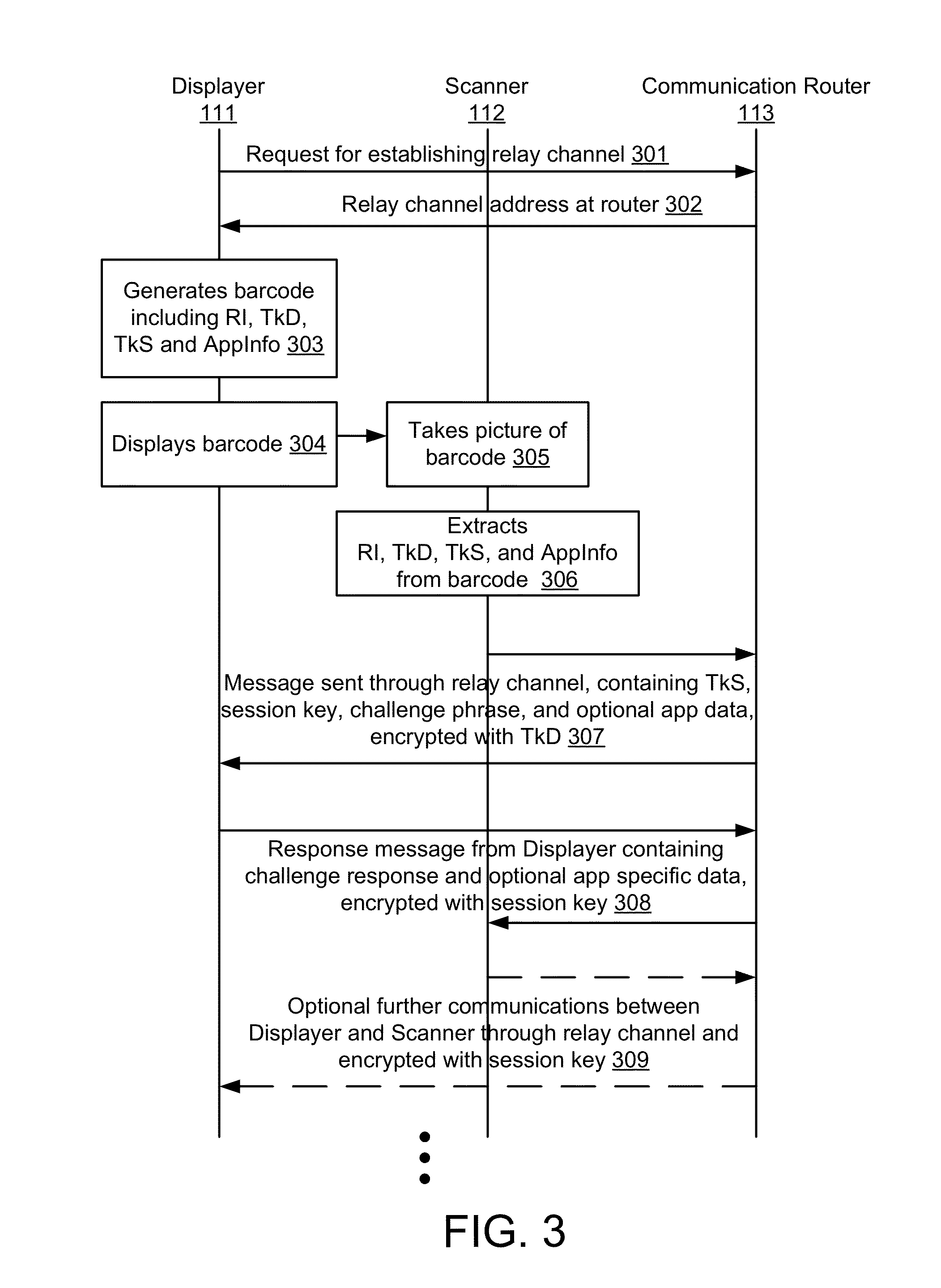

Secure and Authenticated Transactions with Mobile Devices

Embodiments of the invention include a platform for using 2D barcodes to establish secure authenticated communication between two computing devices that are in proximity to each other. A two-tier application architecture using a single base app and dynamic add-on applets is used. 2D barcodes can be distinctively visually branded. According to other aspects, the security of mobile payment systems are enhanced by (1) a triangular payment settlement in which the sender and receiver of payment each submit transaction information independently to the same payment server; (2) sensitive information is split into two parts, one of which is stored on a mobile device, and the other of which is stored on a payment server, and the two parts are only combined and exist transiently in the payment server's volatile memory when executing a transaction; and (3) a process to securely update profile pictures associated with payment accounts.

Owner:NETABPECTRUM

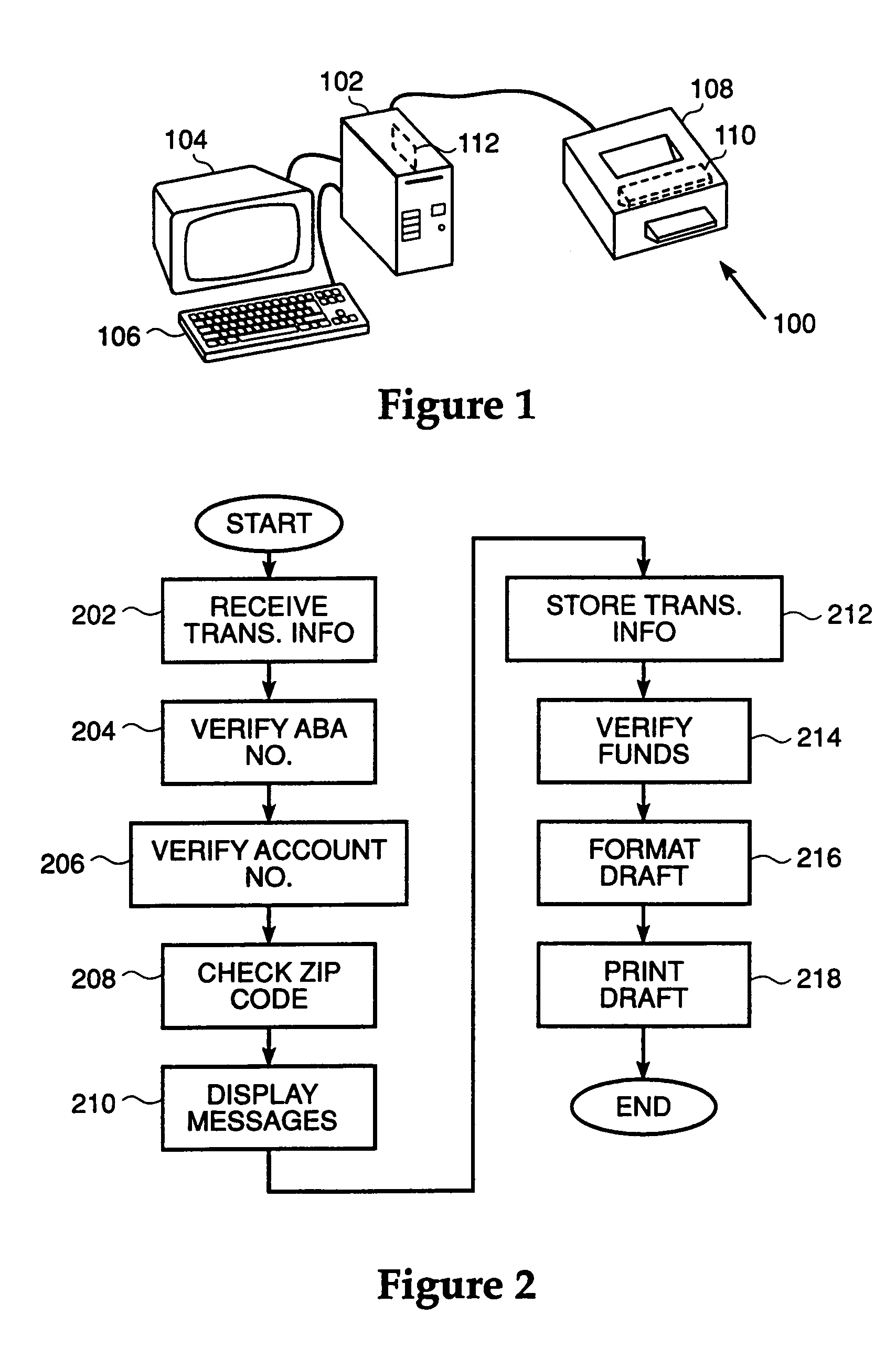

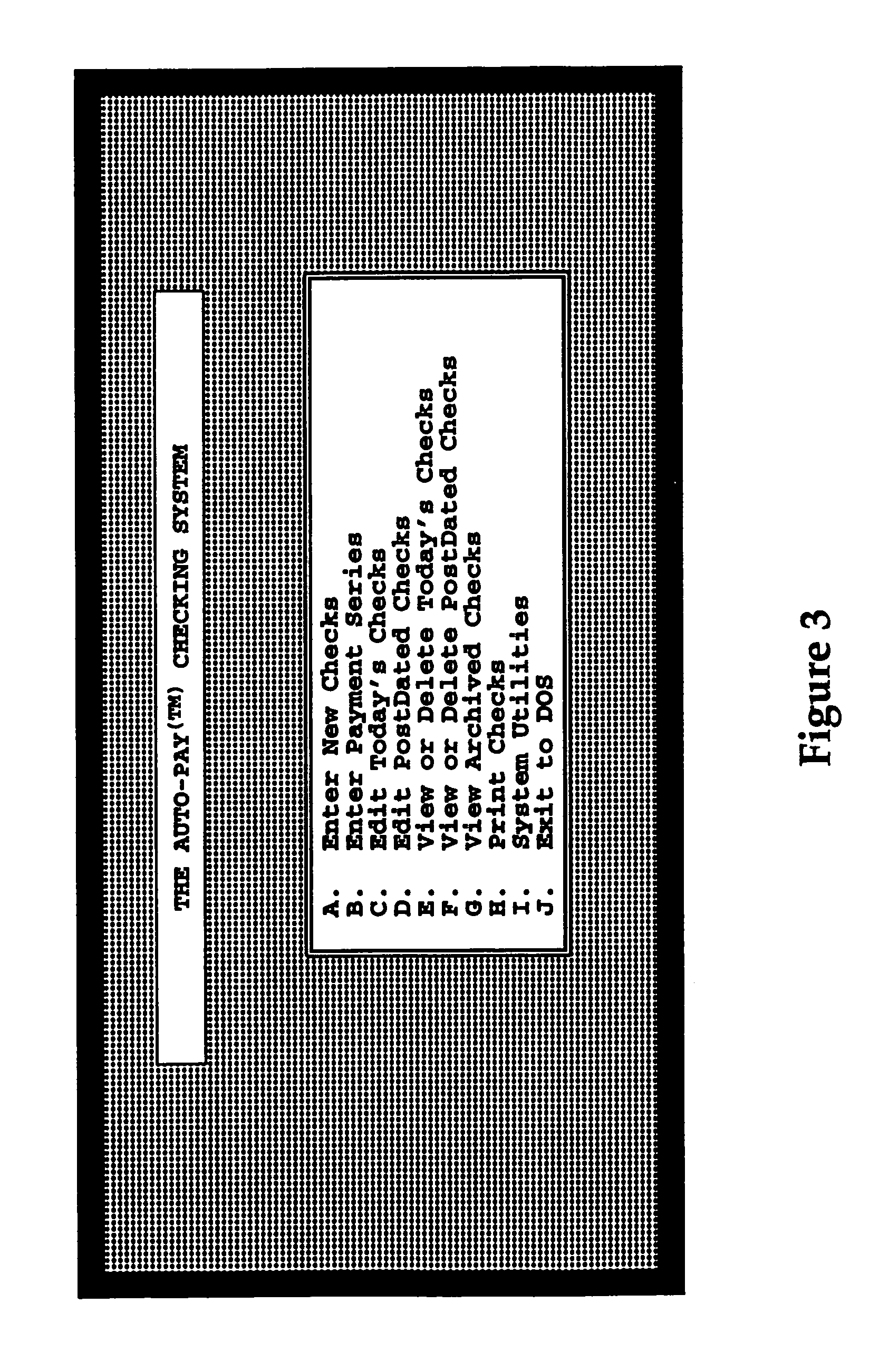

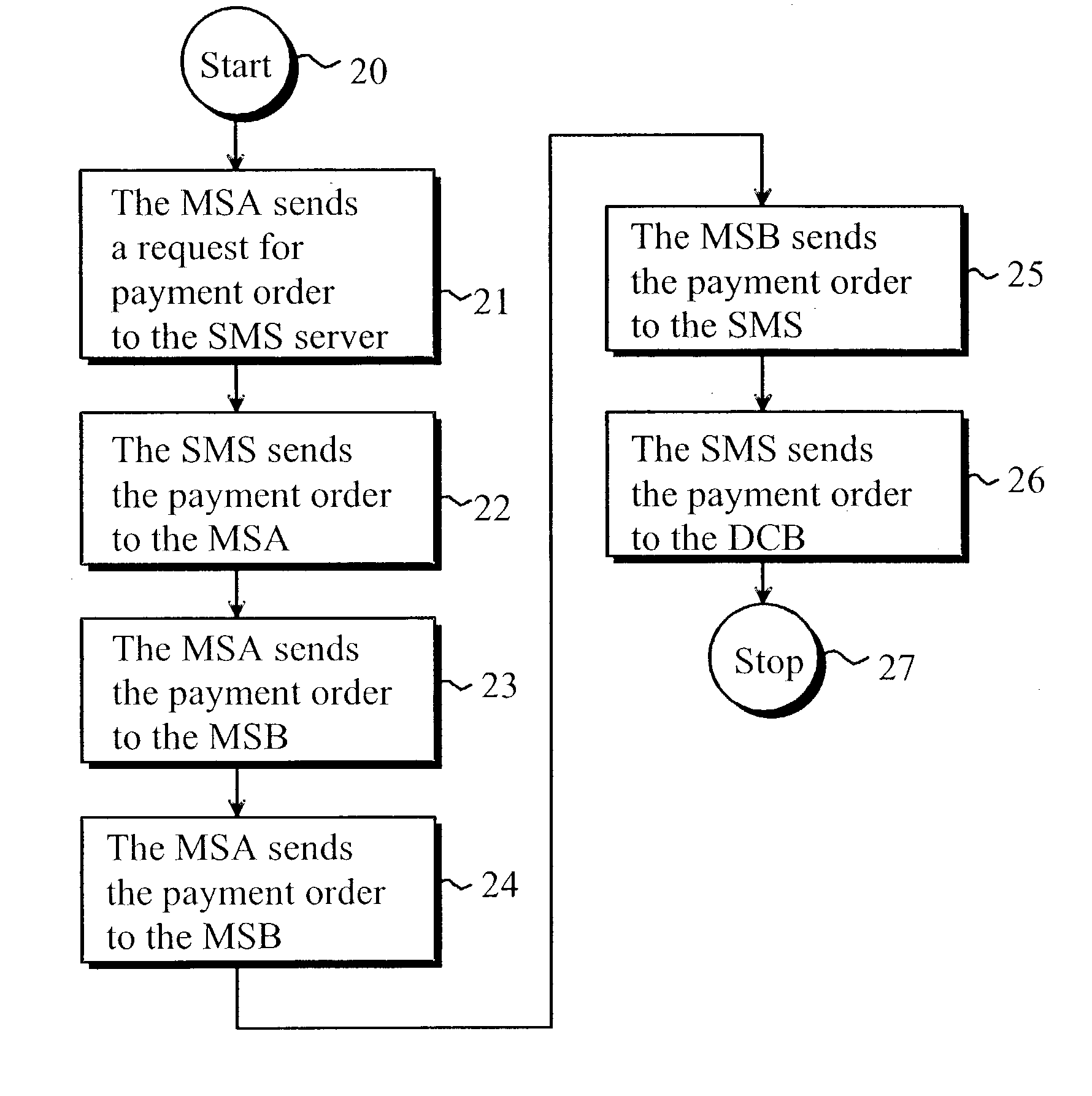

System and method for making a payment from a financial account

InactiveUS7117171B1Promote generationAvoid it happening againFinancePayment circuitsPaymentPayment order

A system and method of collecting payments facilitates authorized generation of a payment order. In a preferred embodiment the automated system has a simple input screen which receives the necessary information for generation of the payment order, which may be read to the system operator over the telephone by the authorizing payor. The system verifies the bank and account information by comparing the input information to records in a database associated with the system. Optionally, the system may also generate an inquiry to the bank to determine the availability of finds in the payor's account.

Owner:AUTOSCRIBE CORP

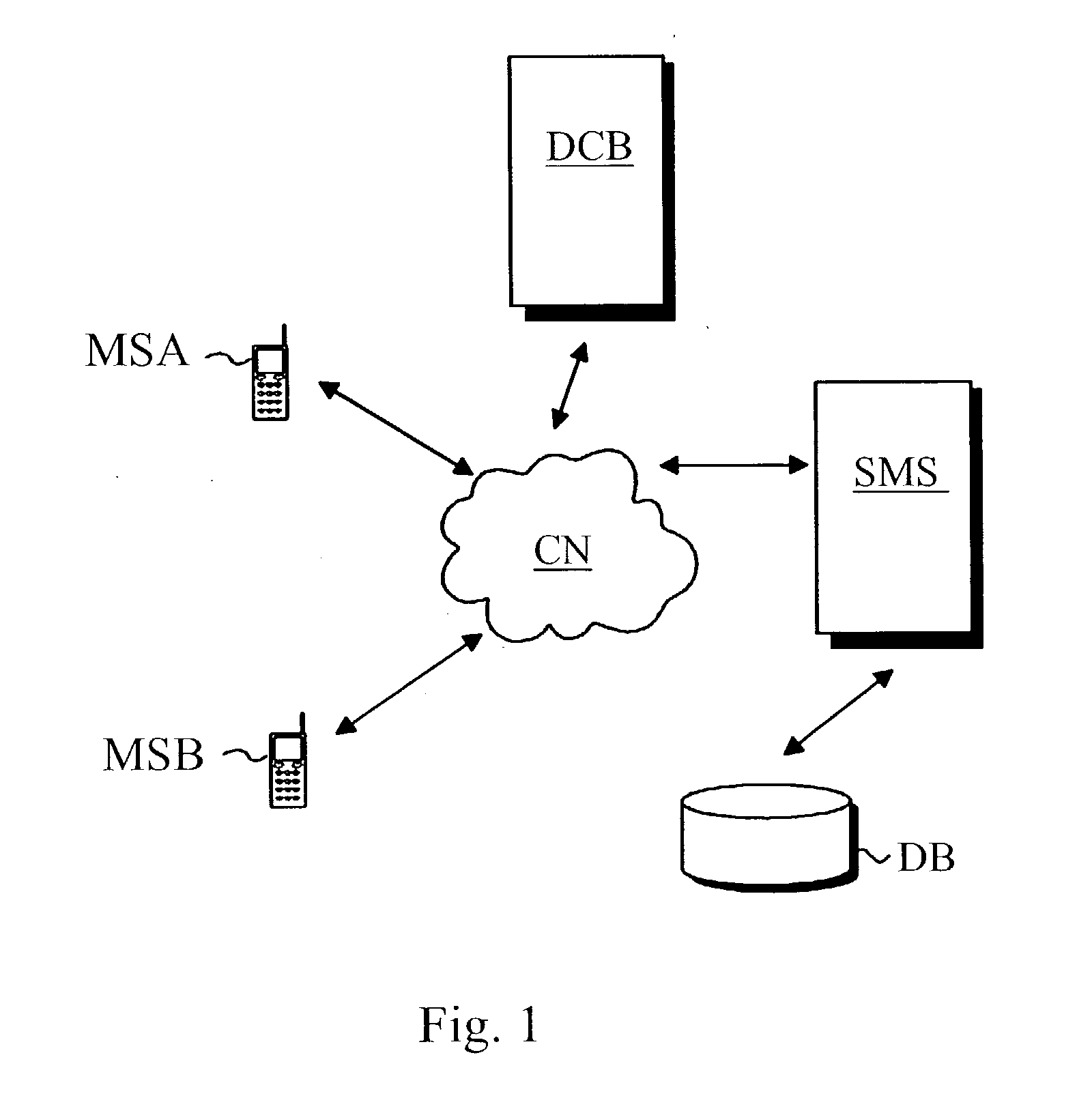

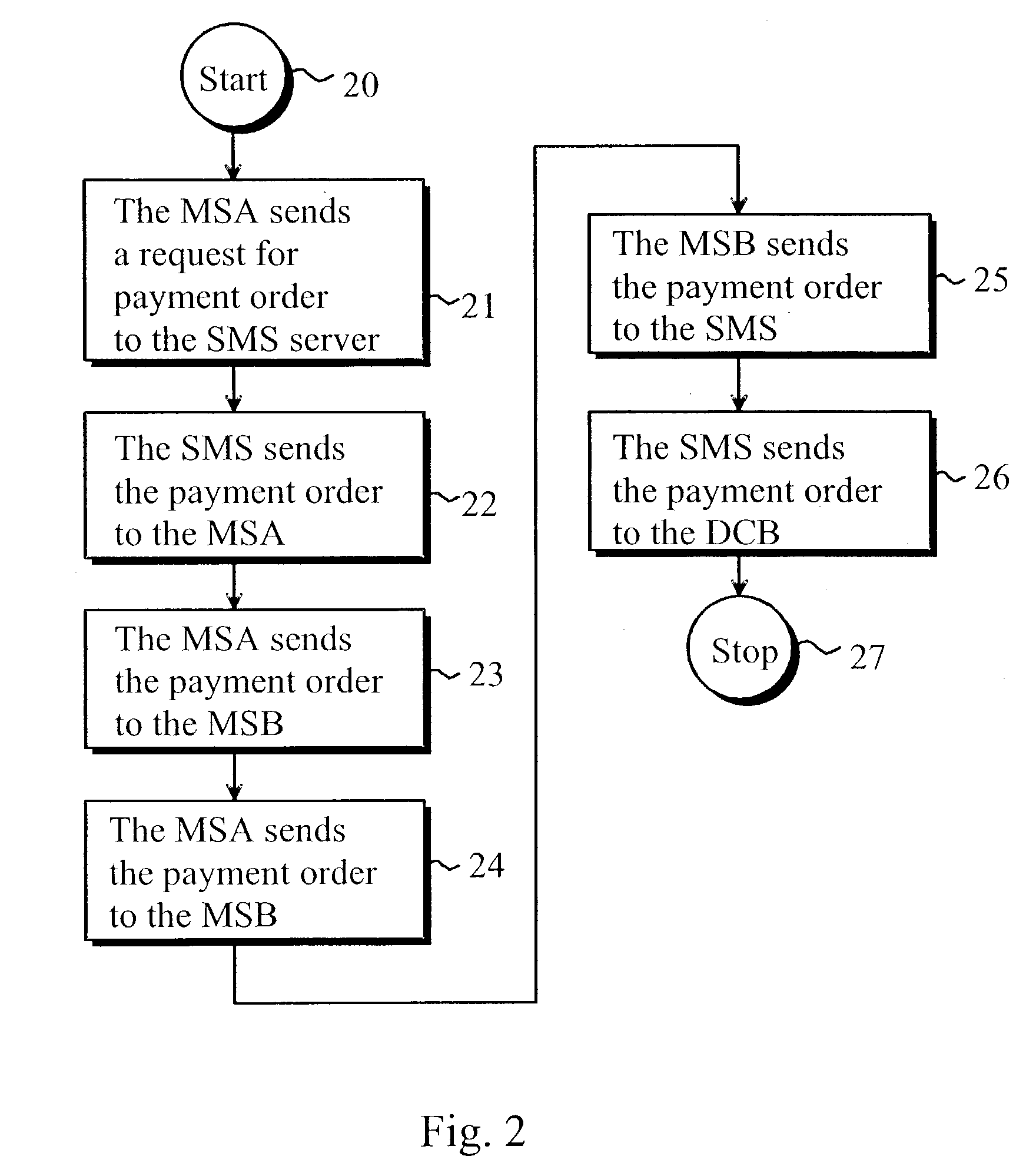

Method of implementing digital payments

ActiveUS20030126078A1Eliminate, orAlleviate, the drawbacks and deficienciesFinanceComputer security arrangementsPaymentTerminal equipment

A method for transferring a digital payment order from a first terminal device to a second terminal device, and for saving the payment order on a payment order server. A payment order request is sent from the first terminal device to the payment order server and, in response, the requested payment order is sent from the payment order server to the first terminal device. The payment order is thereafter transmitted from the first terminal device to the second terminal device, and the payment order is then transferred from the second terminal device to the payment order server to be honored. A message confirming the honoring of the payment order is sent to the second terminal device.

Owner:MIND FUSION LLC

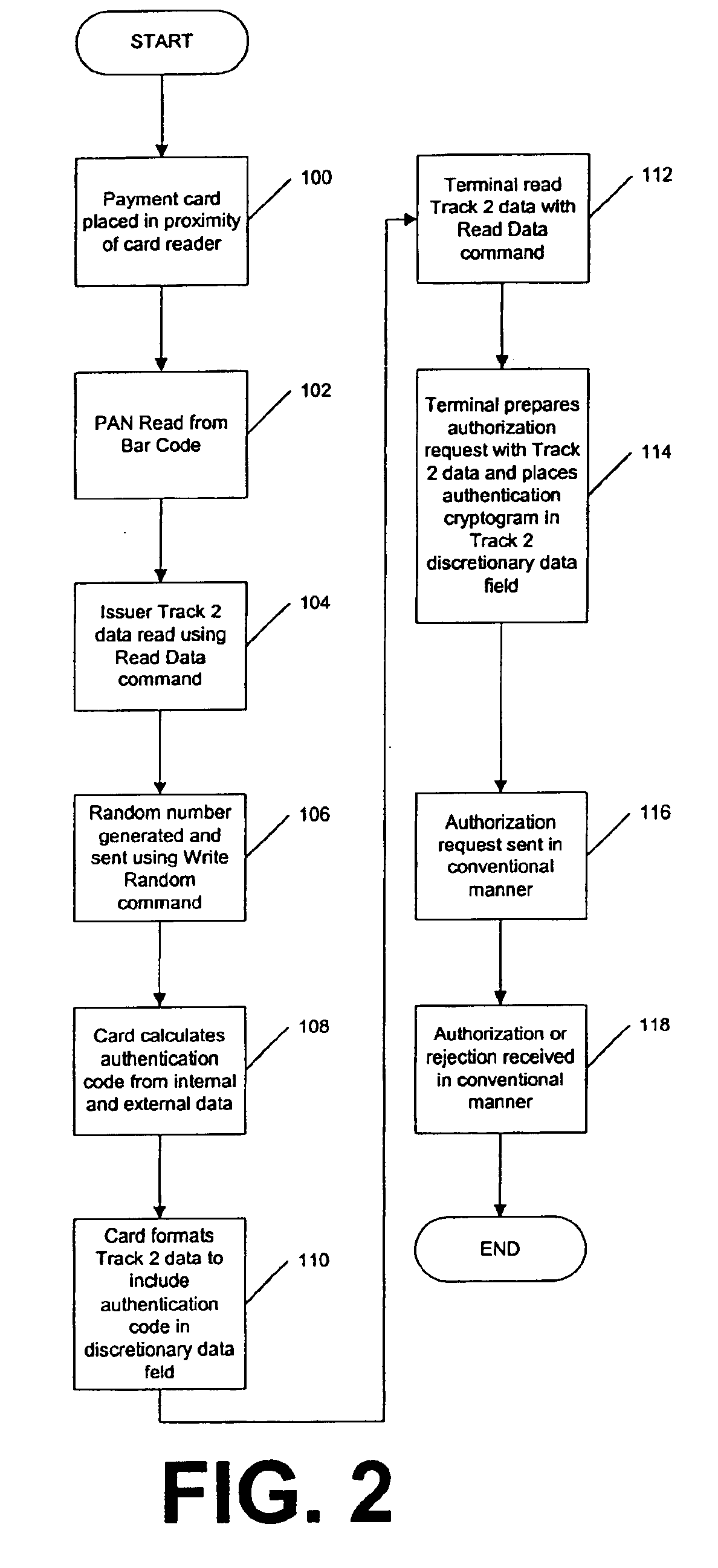

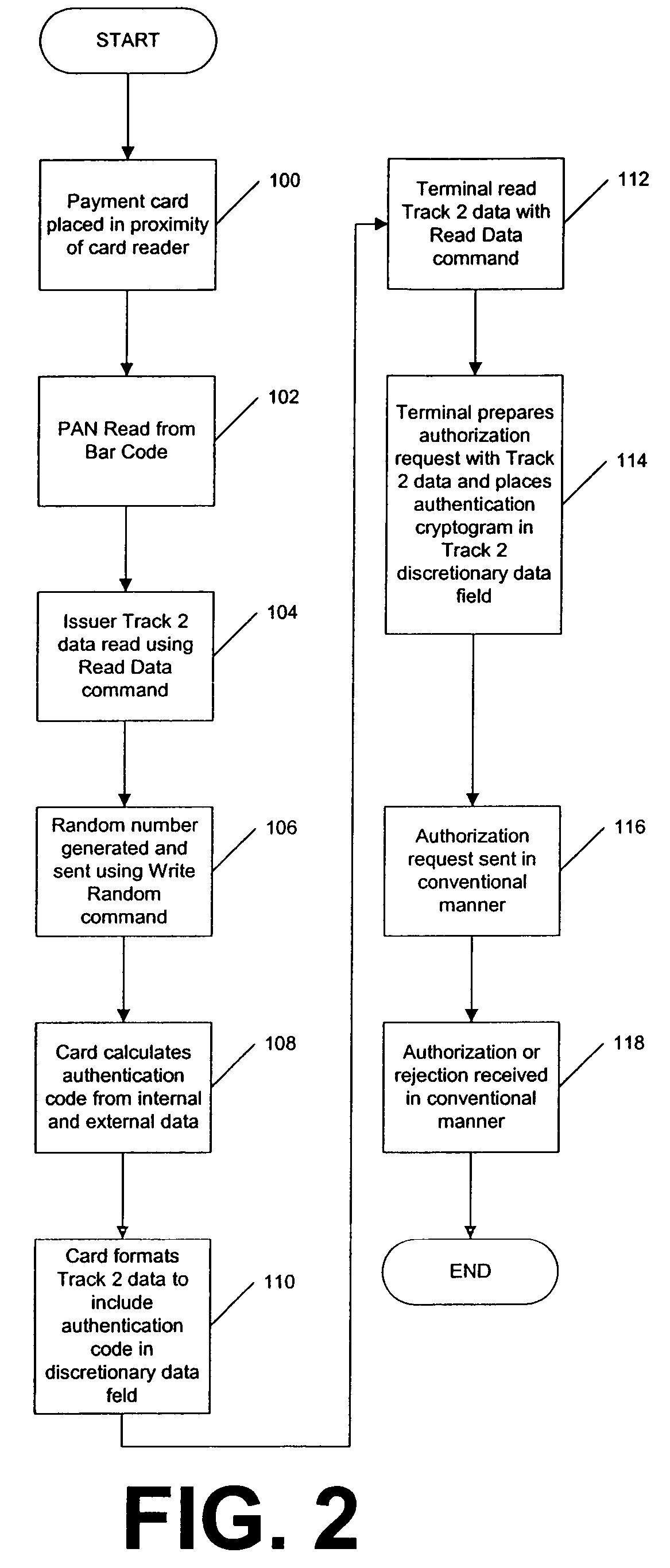

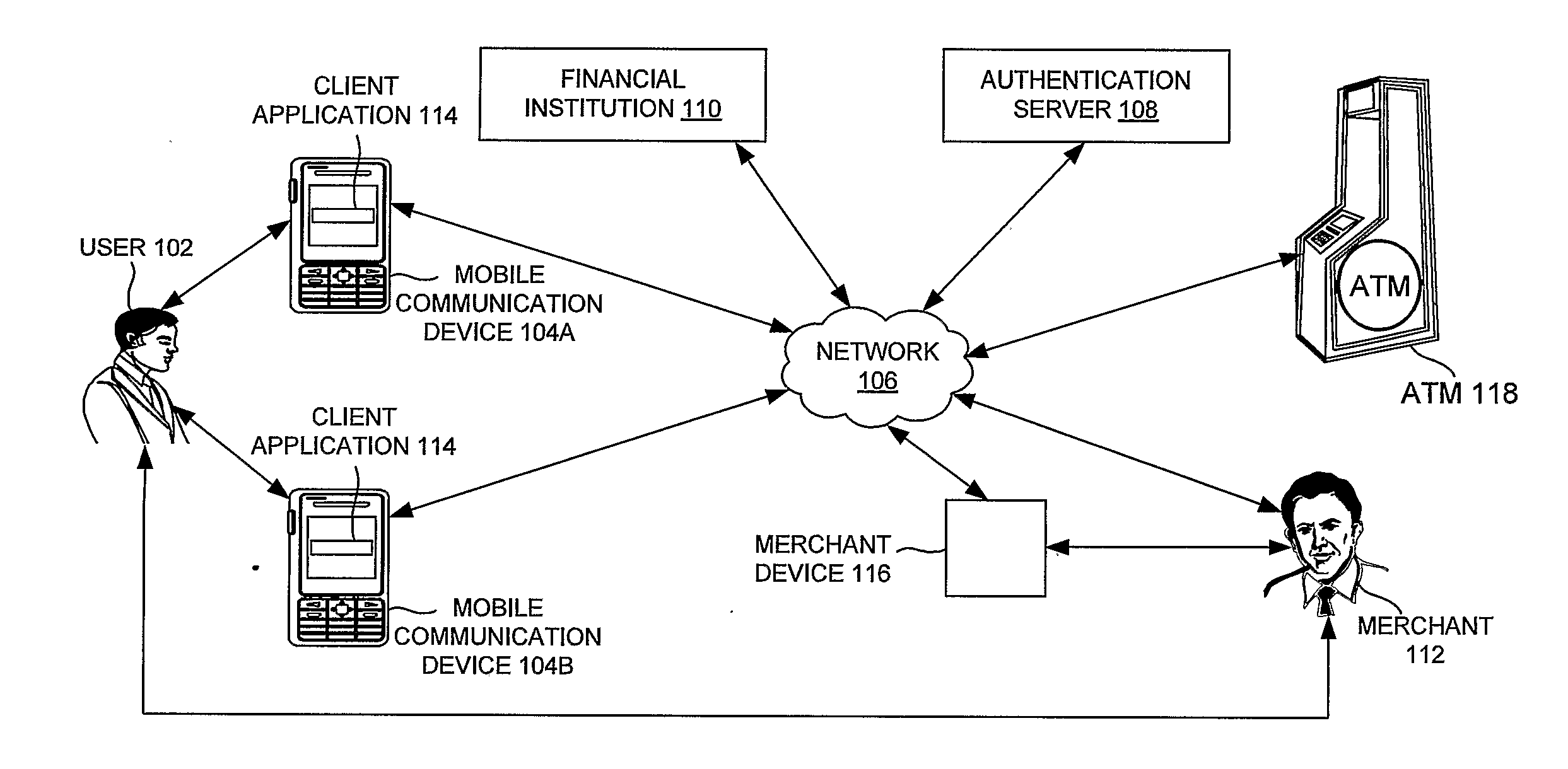

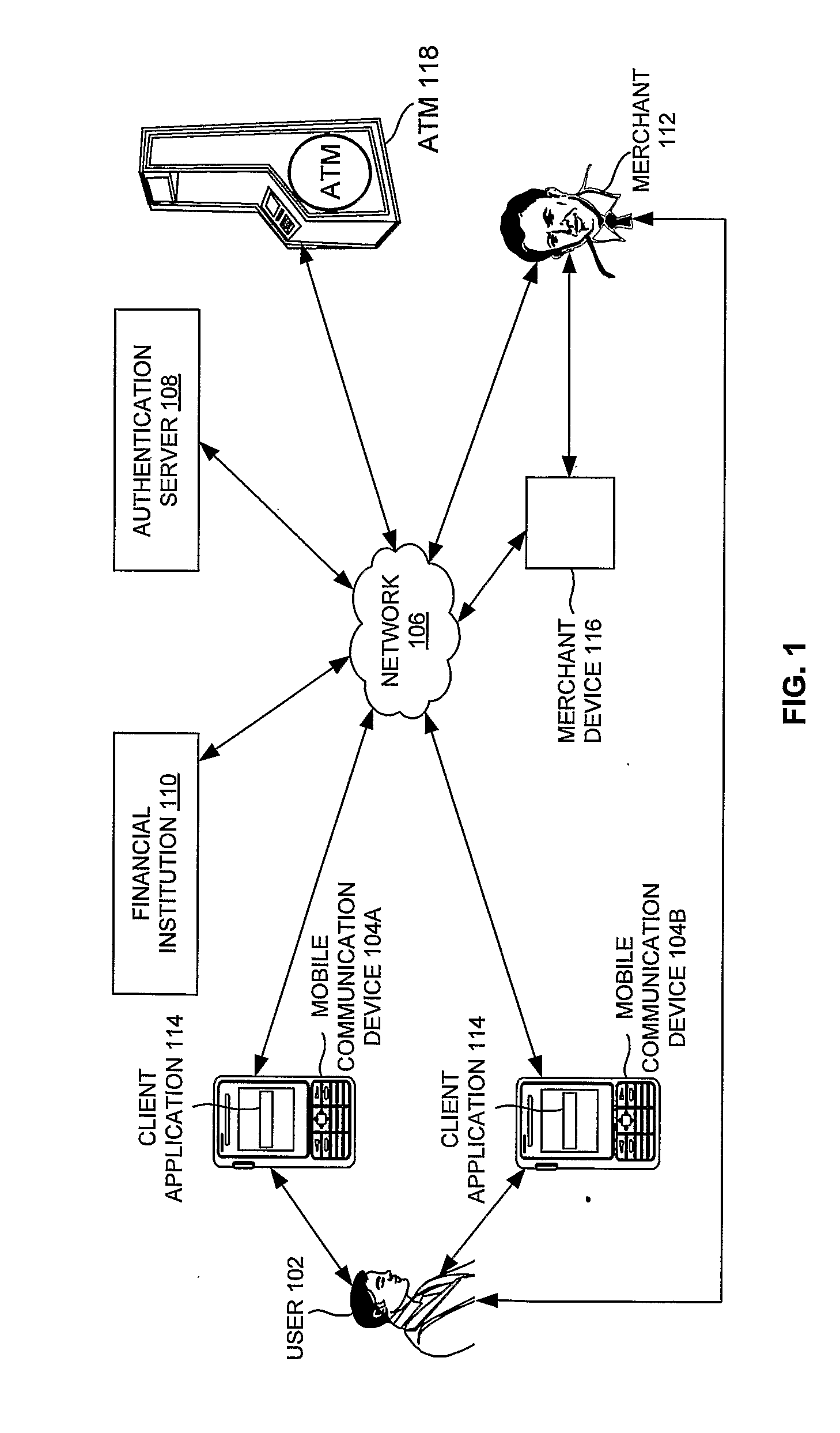

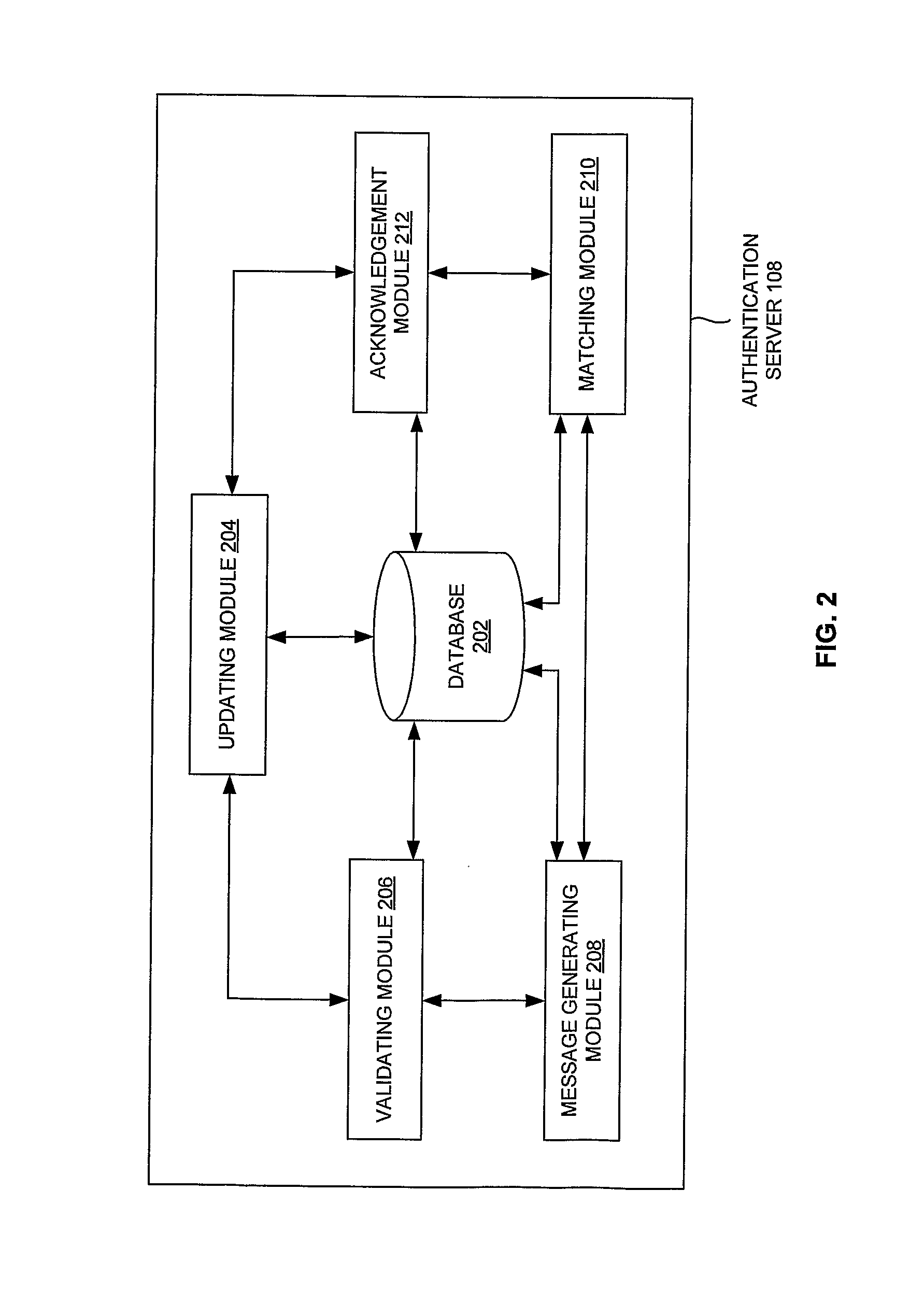

Real time authentication of payment cards

InactiveUS20110078025A1FinancePoint-of-sale network systemsReal time validationFinancial transaction

An authentication sever (108) to authenticate real time a transaction associated with an electronic card performed by a user 102 subscribed to an authentication service having a user subscription database (202) on the authentication server 108 is provided. The authentication server (108) executes including obtaining a confirmation that the user (102) is subscribed to the authentication service, generating a verification code real time triggered by the transaction associated with the electronic card, communicating the verification code to a mobile communication device (104 A-B) associated with the user, processing a verification message based on the verification code and a mobile communication device information associated with the mobile communication device (104 A-B), and authenticating the transaction if the verification message and the mobile communication device information matches an information associated with the user subscription database. The verification message and the mobile communication device information are obtained from the mobile communication device (104A-B) real time.

Owner:SHRIVASTAV SHOURABH

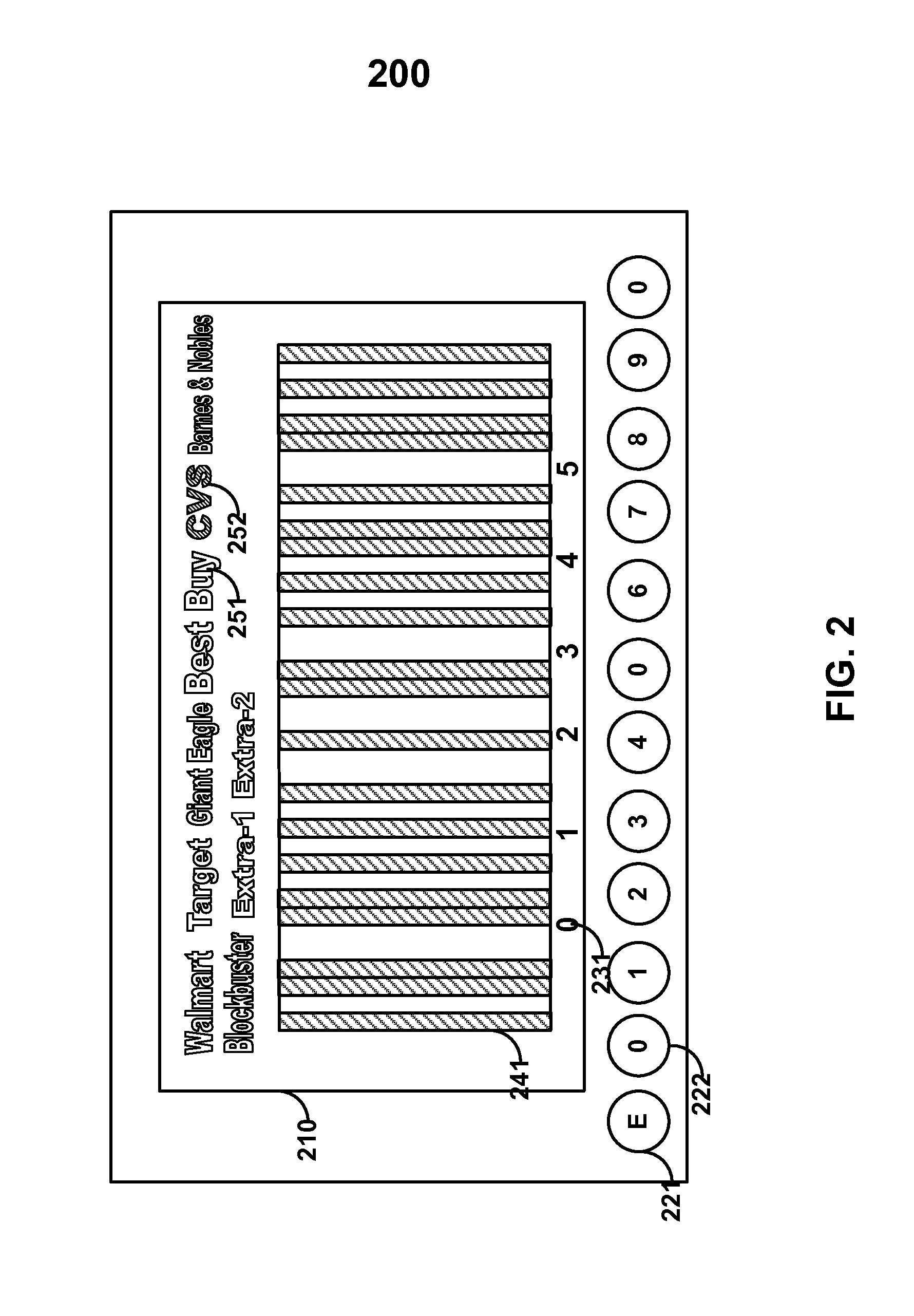

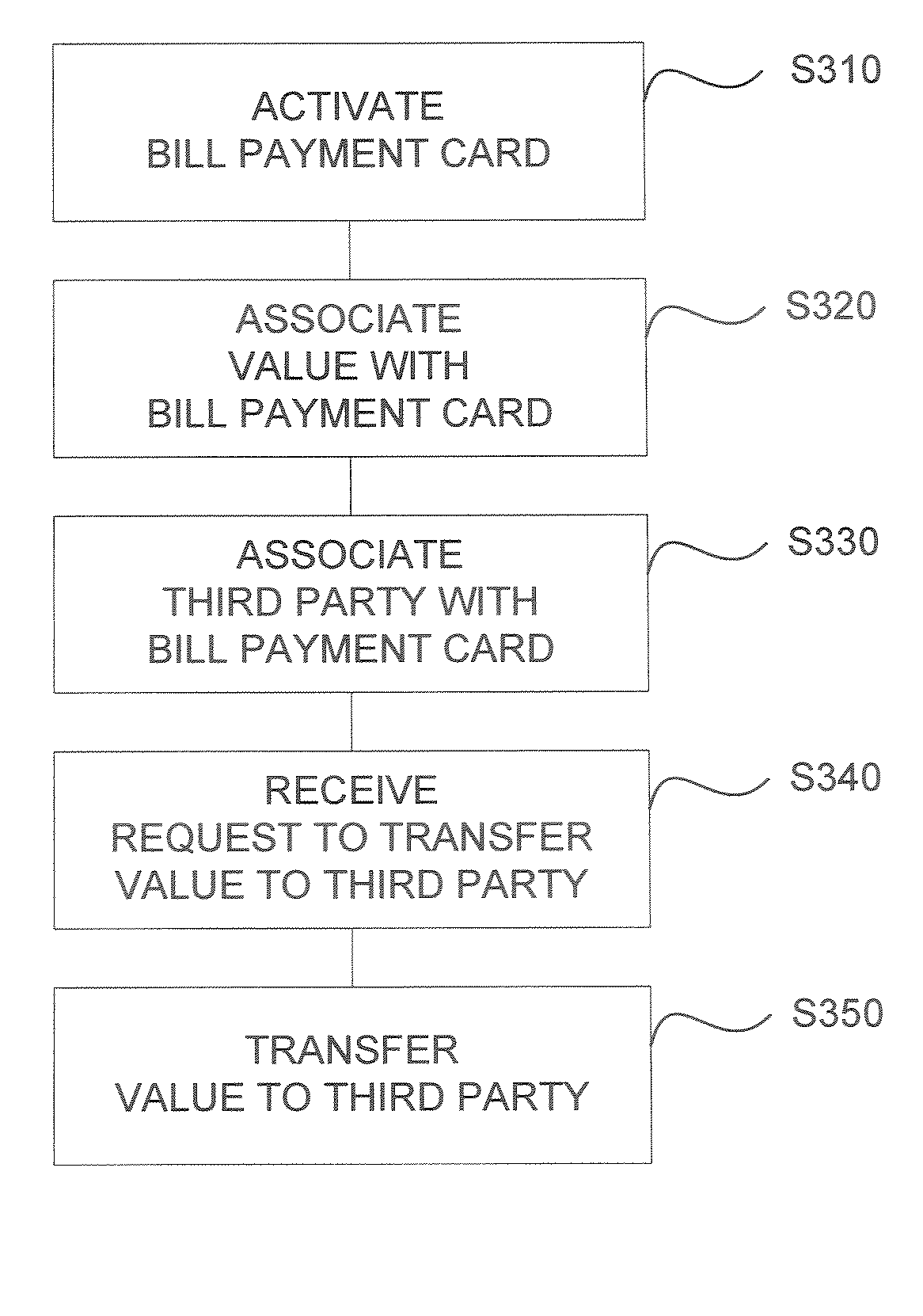

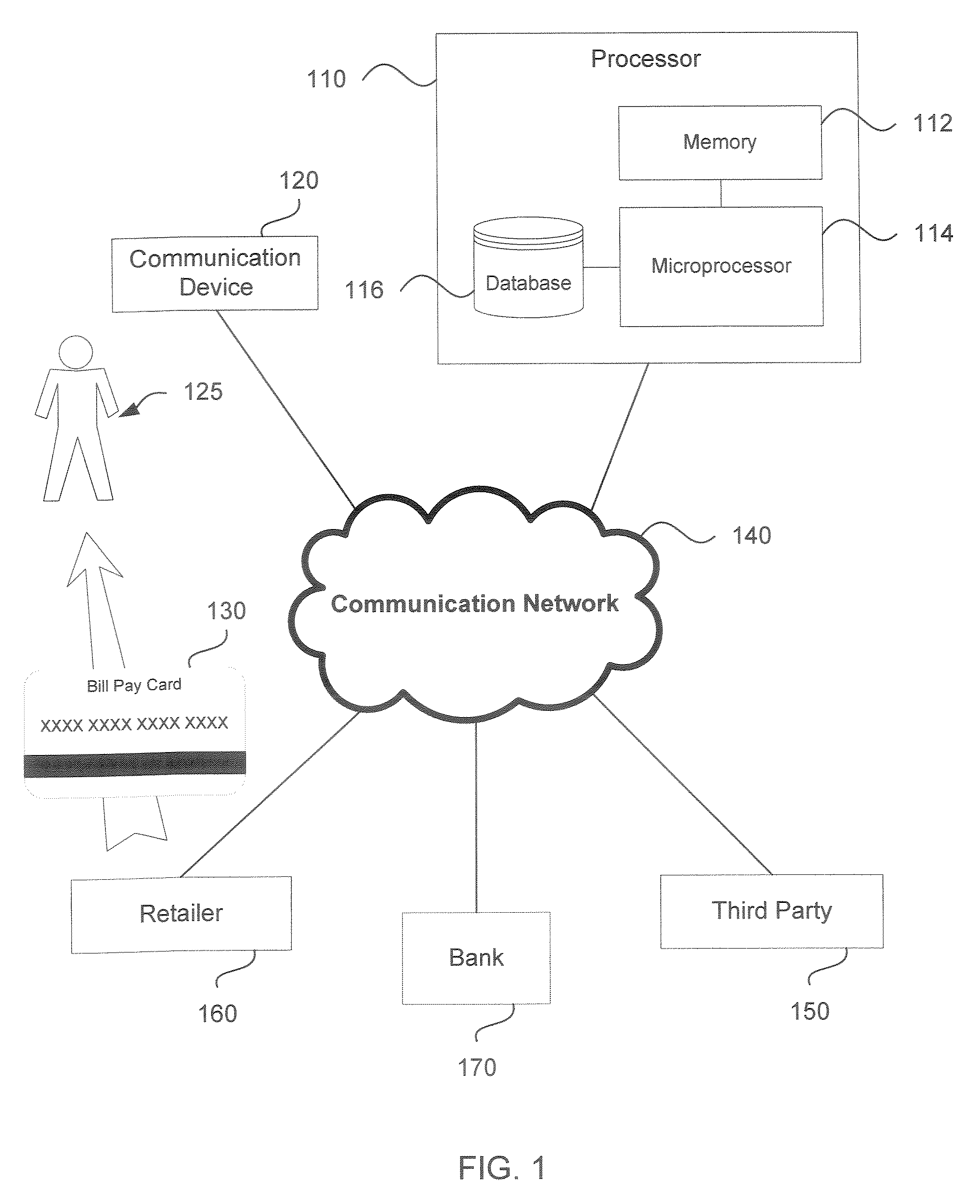

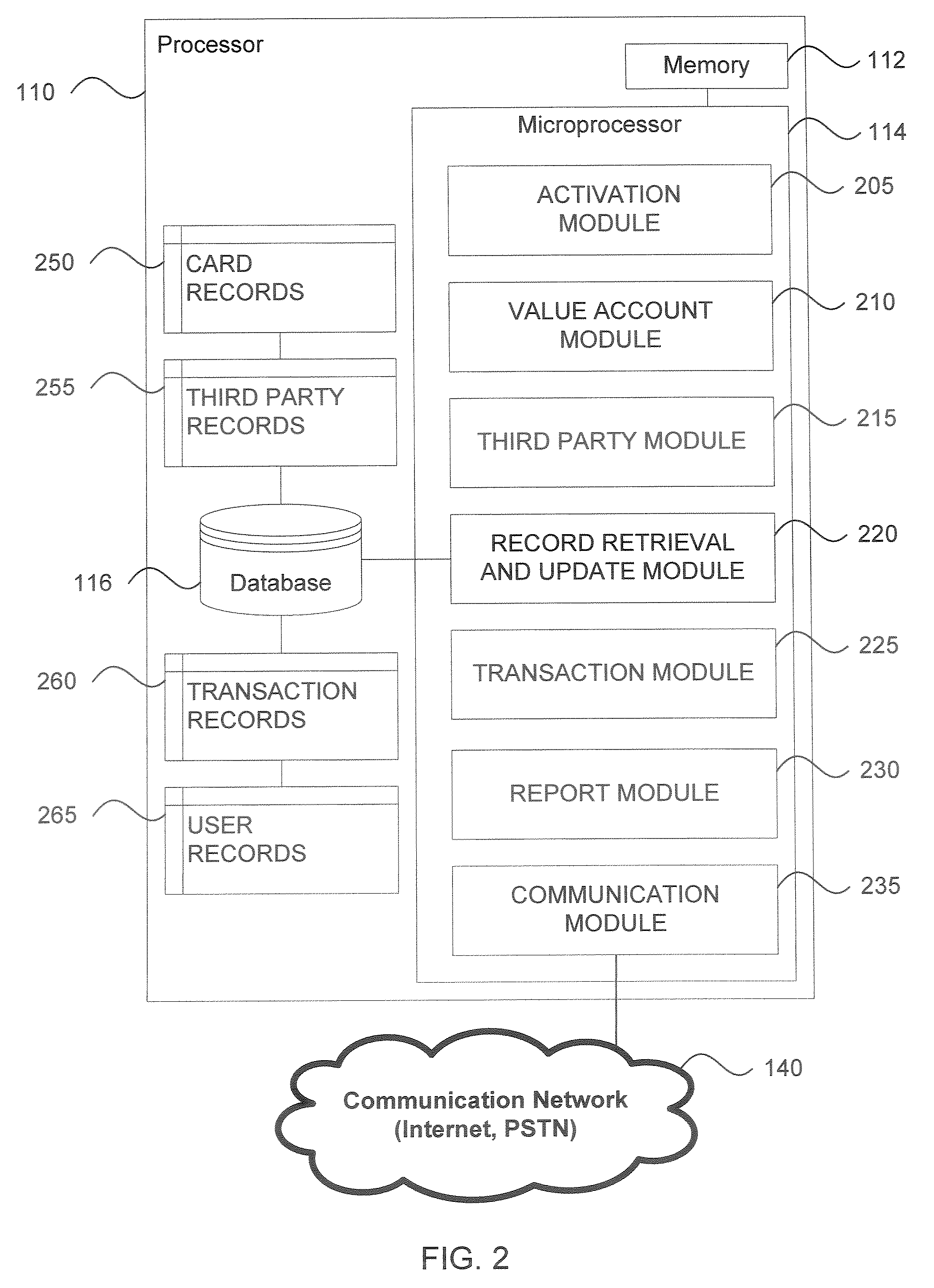

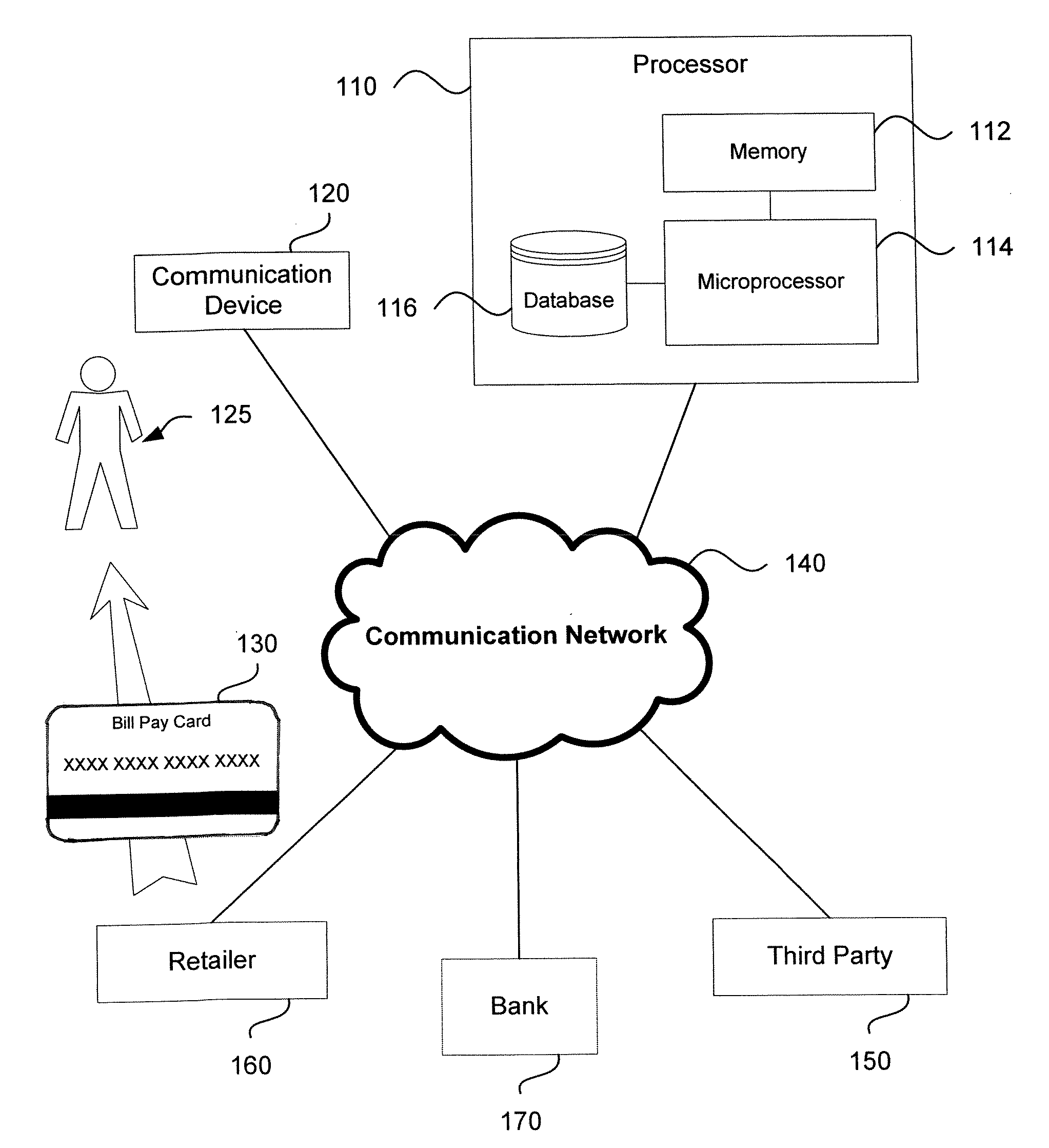

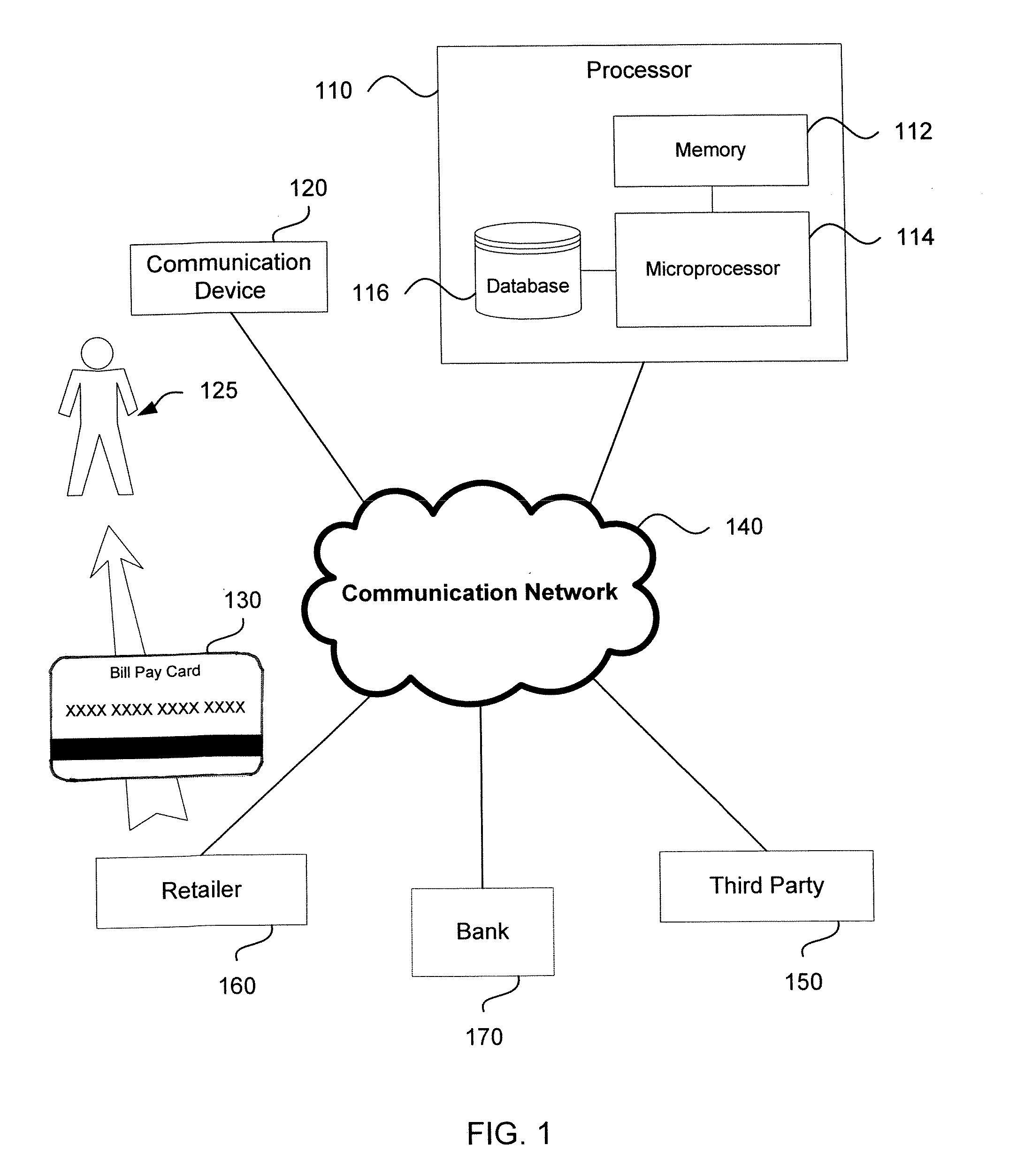

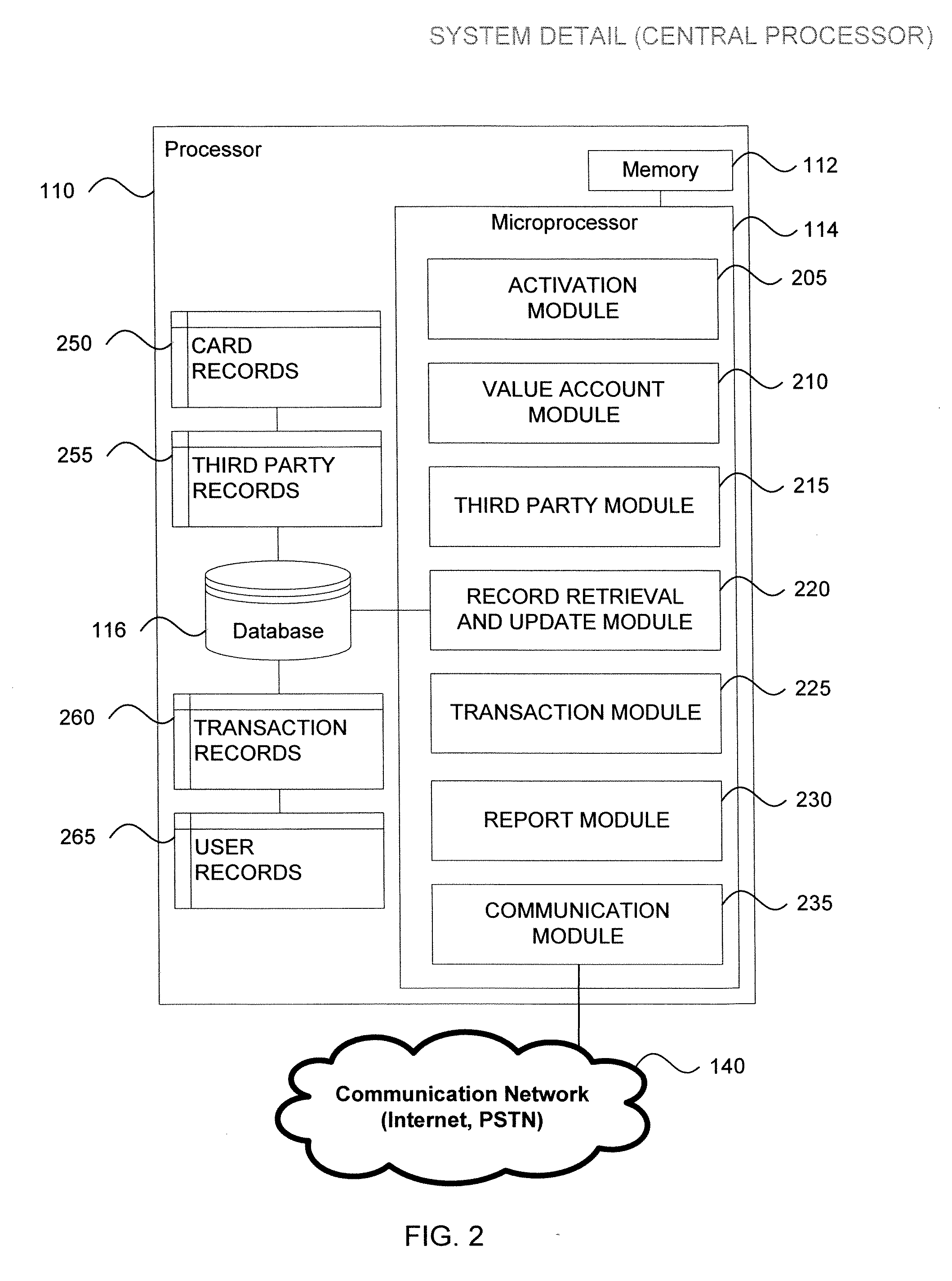

Bill Payment Card Method and System

The invention is directed to a system and method for managing a payment system. The method generally comprises activating a payment card, associating a value with the payment card, associating at least one third party with the bill payment card, receiving a request from a bill payment card user to transfer at least some of the value to a selected third party, the request comprising receiving an identifier associated with the payment card and receiving an indication of an amount of value to transfer, and transferring at least some of the value to the selected third party. Systems of the invention may generally comprise one or more payment cards, a database storing a plurality of records comprising information related to the payment card; one or more communication devices; and a processor in communication with the database and in selective communication with the communication device.

Owner:E2INTERACTIVE INC D B A E2INTERACTIVE

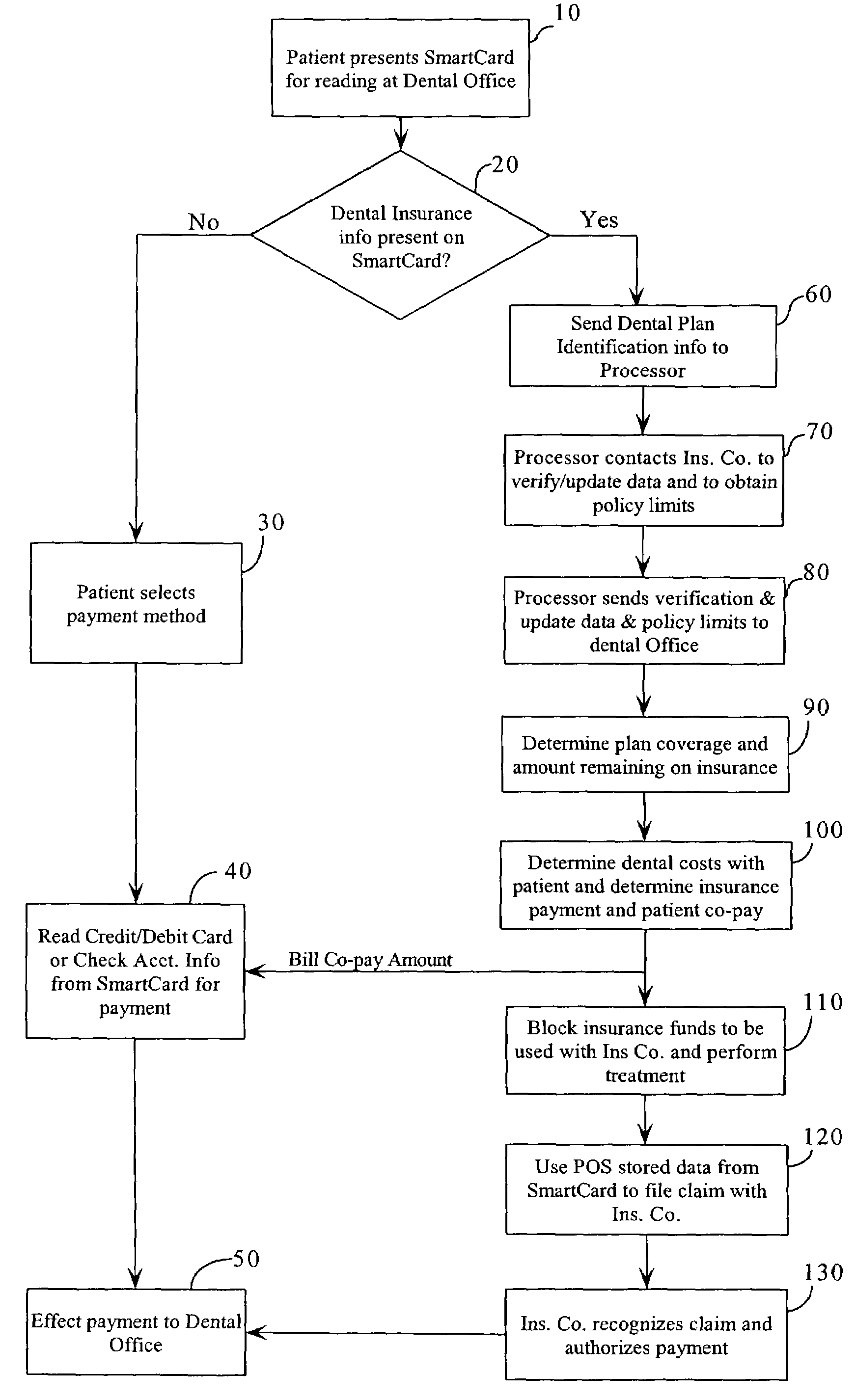

Payment convergence system and method

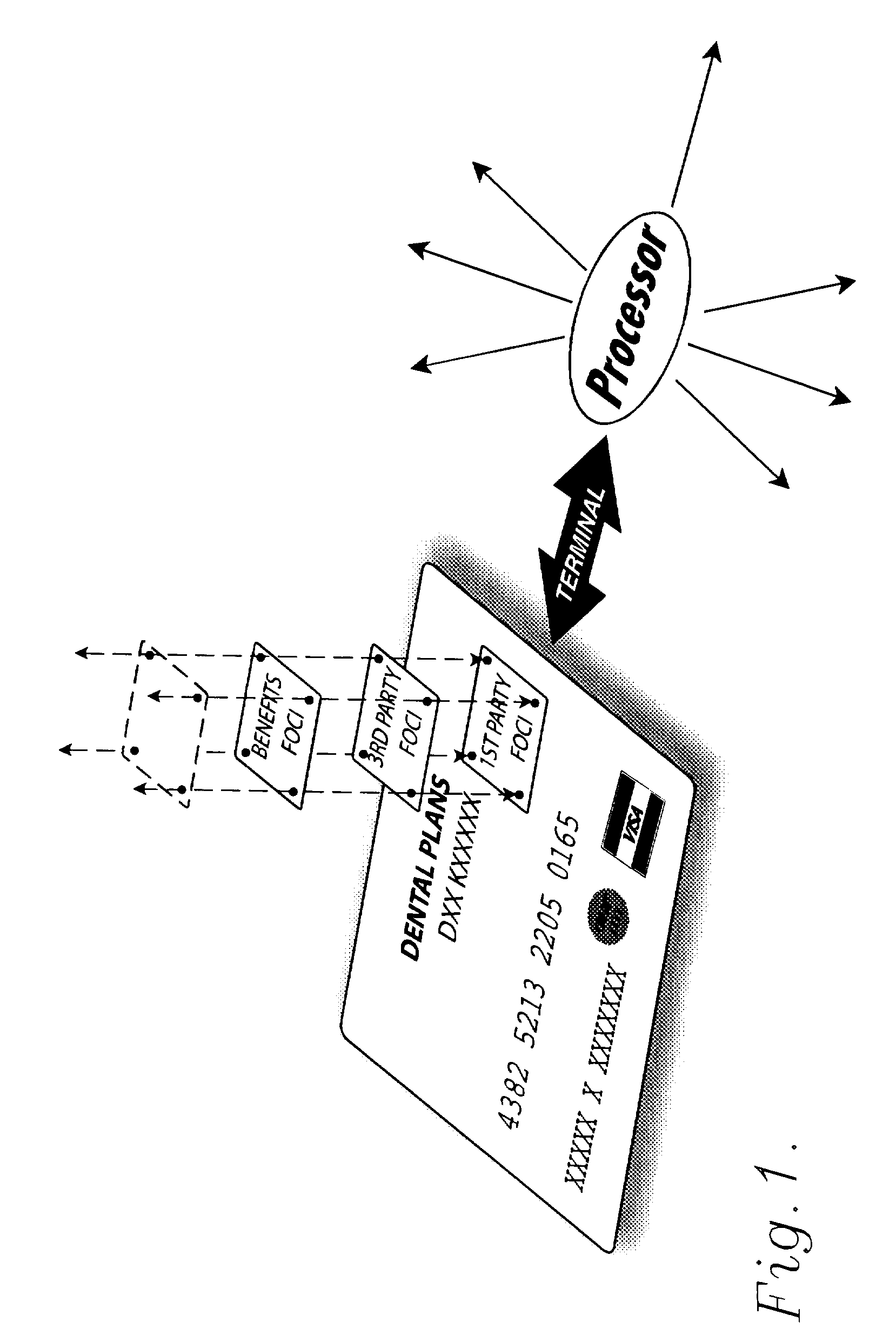

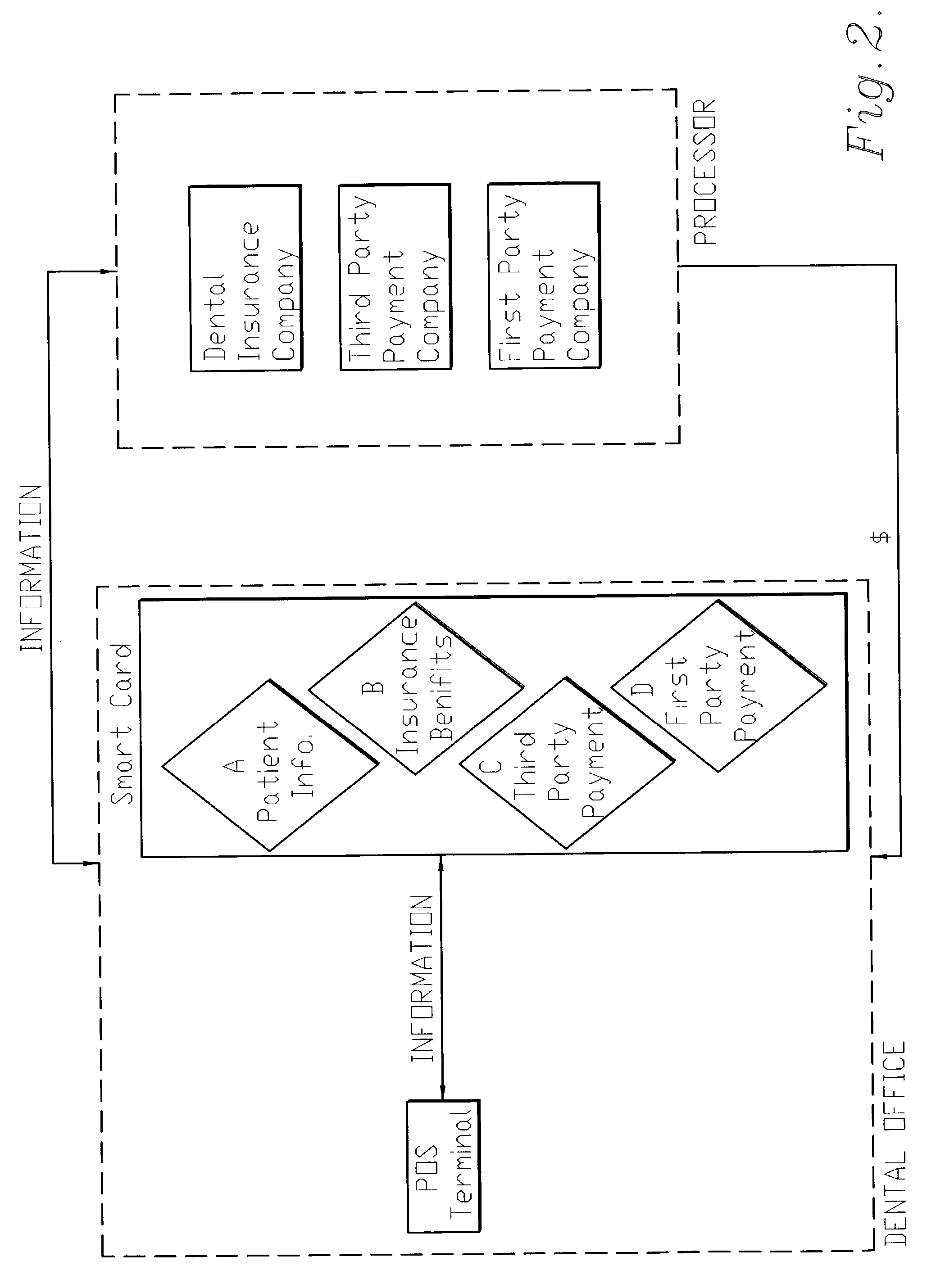

A method and system is provided for convergence of multiple independent applications into a single payment vehicle. In the context of a medical procedure, the invention provides for the convergence of medical / dental insurance with at least one secondary payment source to effect payment for the entire procedure. Through the instant invention insurance benefit information can be determined and funds blocked, then secondary payment source(s) can be utilized to effect payment of the insurance co-payment amount. The use of Smart Card technology enables the convergence at the point of sale of information about multiple applications / payment sources (i.e. insurance plan and secondary payment plan) that are processed to determine the amount of payment to be received from each source.

Owner:CARDTEK INT INC

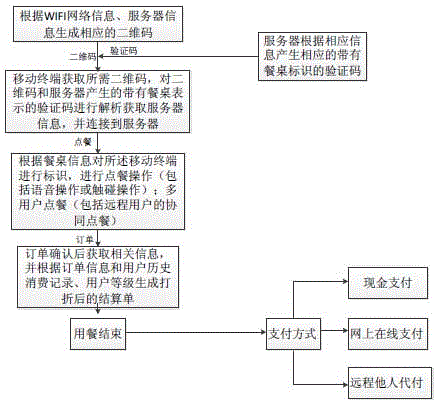

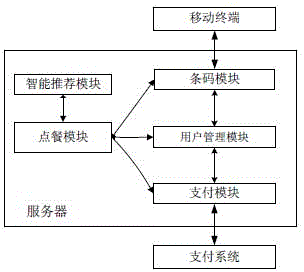

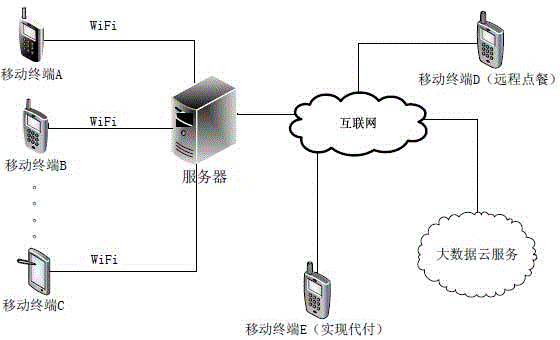

Two-dimensional code-based cooperative intelligent ordering method and system

InactiveCN104978697AOptimize dish informationAvoid the situation of "one dish is fried many times"Data processing applicationsTablet computerPayment

The invention discloses a two-dimensional code-based cooperative intelligent ordering method and system. The system comprises a mobile terminal with a two-dimensional code scanning function and a server supporting ordering and payment functions. The mobile terminal can be an intelligent mobile phone and a tablet computer. The server is used for processing ordering information, and mainly comprises a barcode module, an ordering module, a user management module, an intelligent recommendation module and a payment module; the barcode module mainly comprises two-dimensional code and verification code generation and verification functions; the ordering module is used for supporting ordering (including remote ordering) of multiple persons and voice ordering; the user management module is mainly used for automatically identifying user identities and storing user consumption information; the intelligent recommendation module is mainly used for providing big data cloud services for merchants, digging user consumption habits, tastes and the like according to user consumption records and providing personalized dish and service recommendations for users; and the payment module is mainly used for supporting transaction of cash, electronic payment (including remote payment for another) and the like.

Owner:SOUTHWEST PETROLEUM UNIV

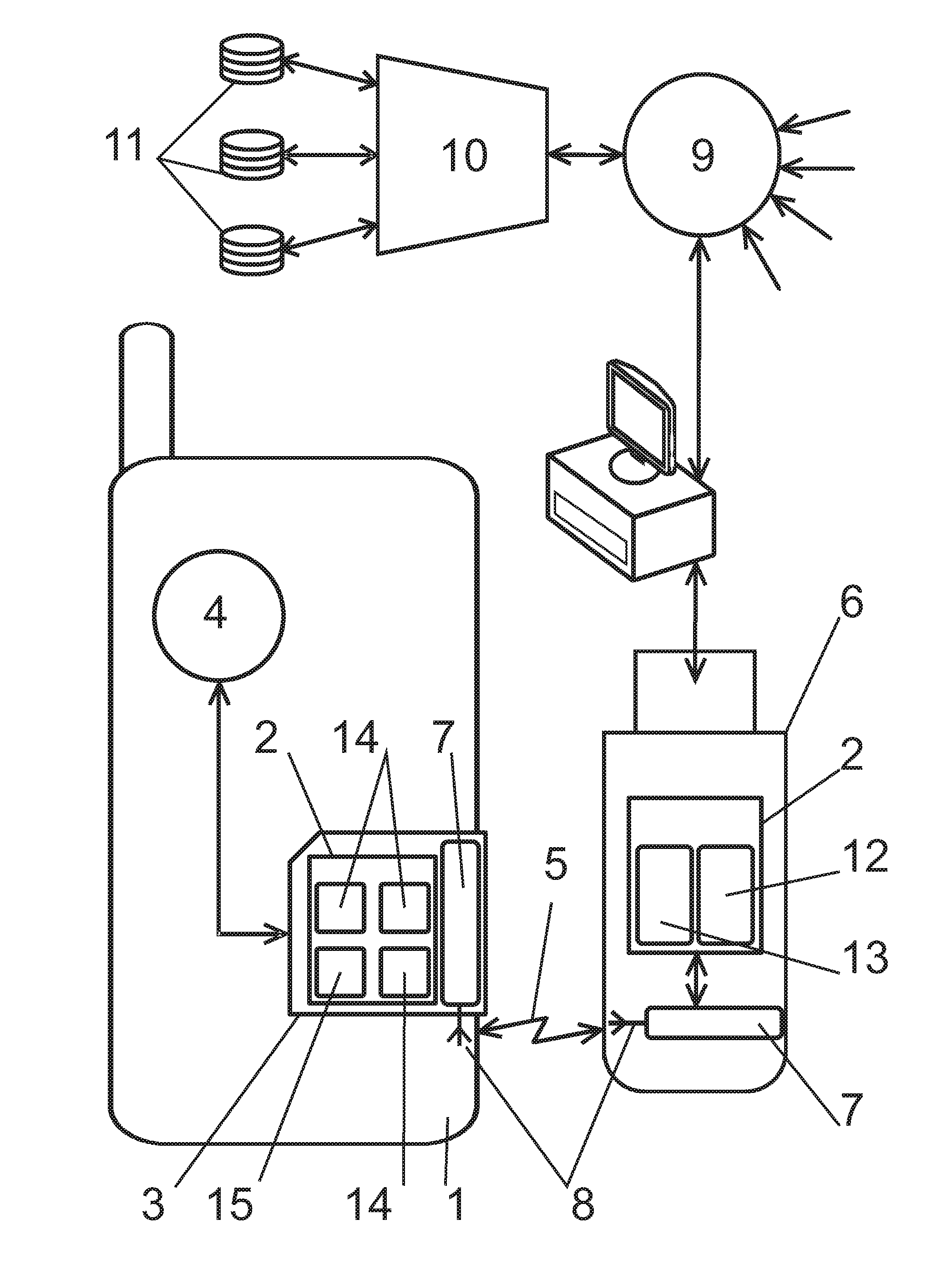

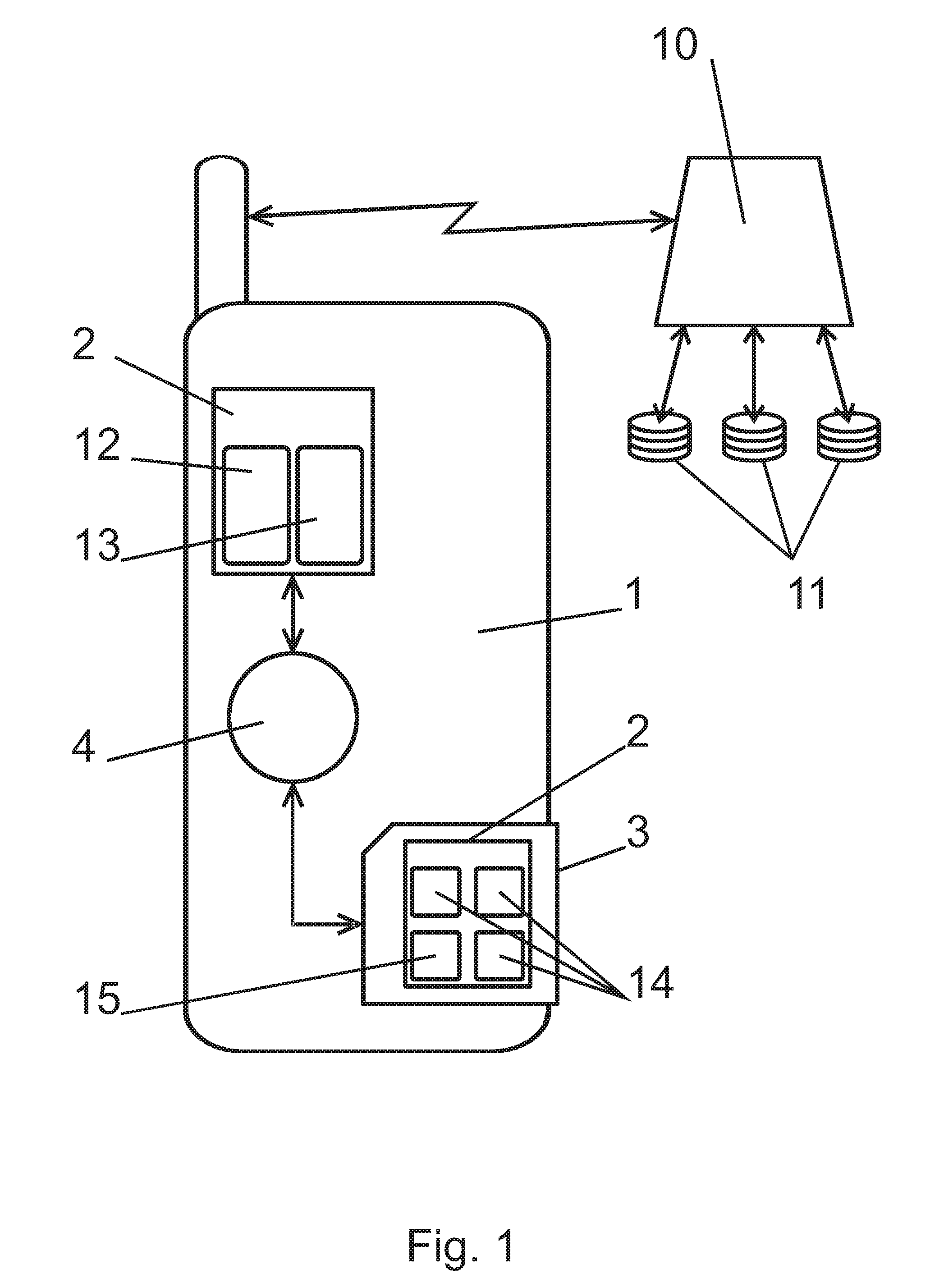

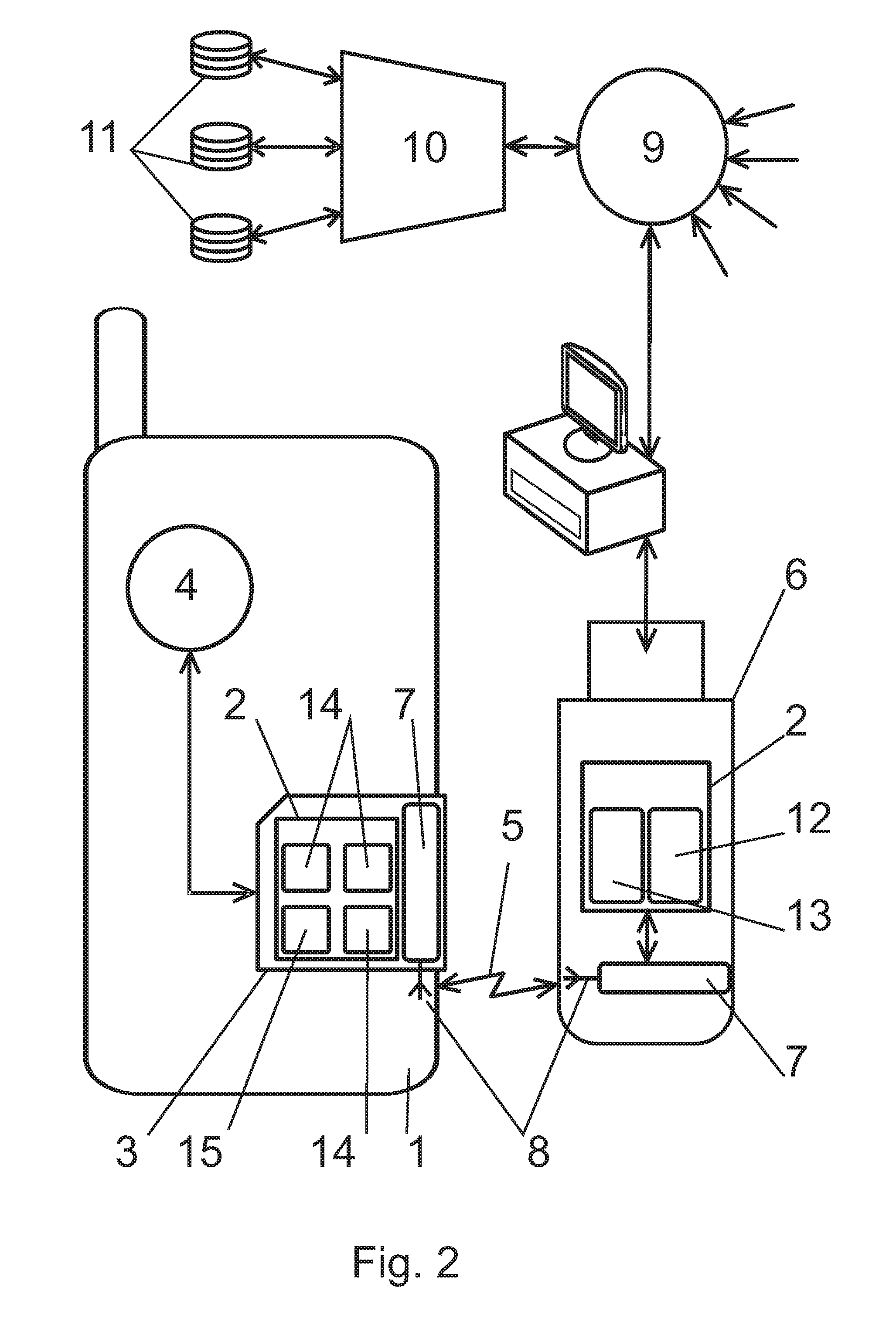

Electronic payment application system and payment authorization method

The system contains a virtual POS terminal's unit in the user's personal device. The mobile communication device (1) contains a virtual POS terminal's unit (4) and also a removable memory card (3), on which there are at least two physically separate secure elements (2) stored. The removable memory card (3) is connected to the secure element (2) containing the secured part of the virtual POS terminal. The mobile communication device (1) and / or the separate portable element (6) is adjusted in such a way to be able to connect to a remote payment procession server. The removable memory card (3) and the separate portable element (6) can be equipped with the NFC communication element. Depending on the user choice, a corresponding secure element (2) with the selected payment card unit (14) is activated on the removable memory card (3). The user's payment card's identification data are supplemented by the payment receiver's identification data and also by a one-time password that was created in the one-time password unit.

Owner:SMK CORP

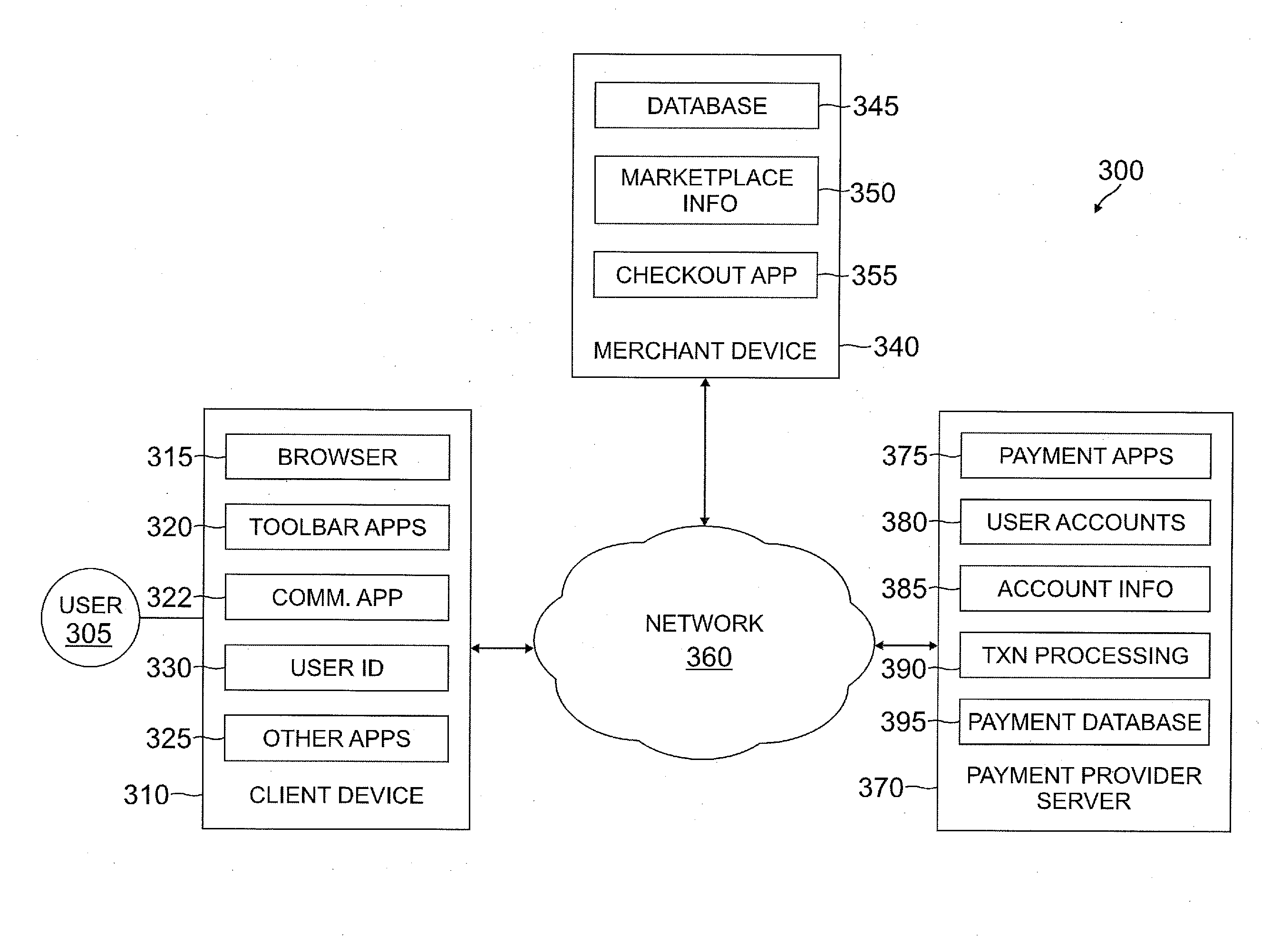

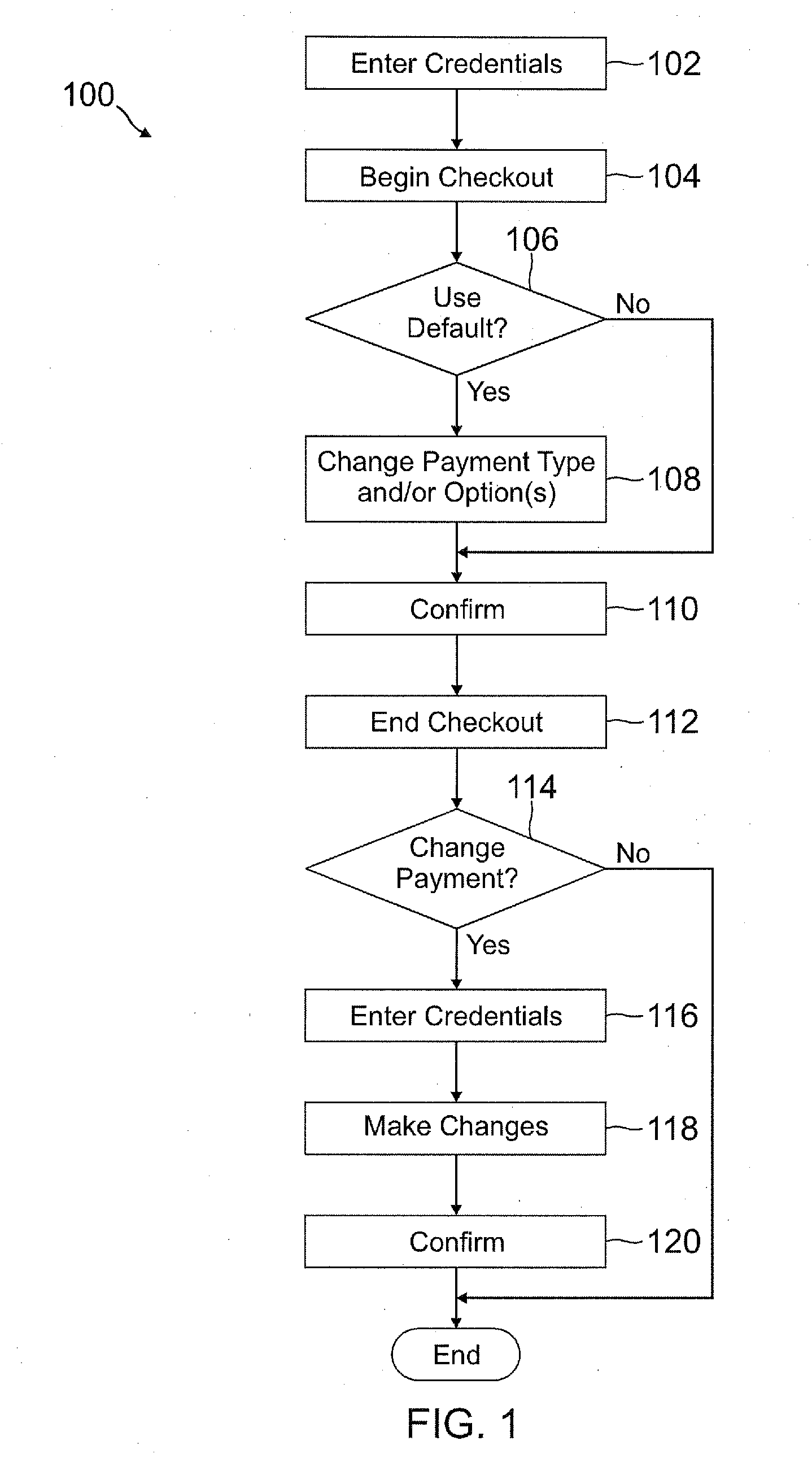

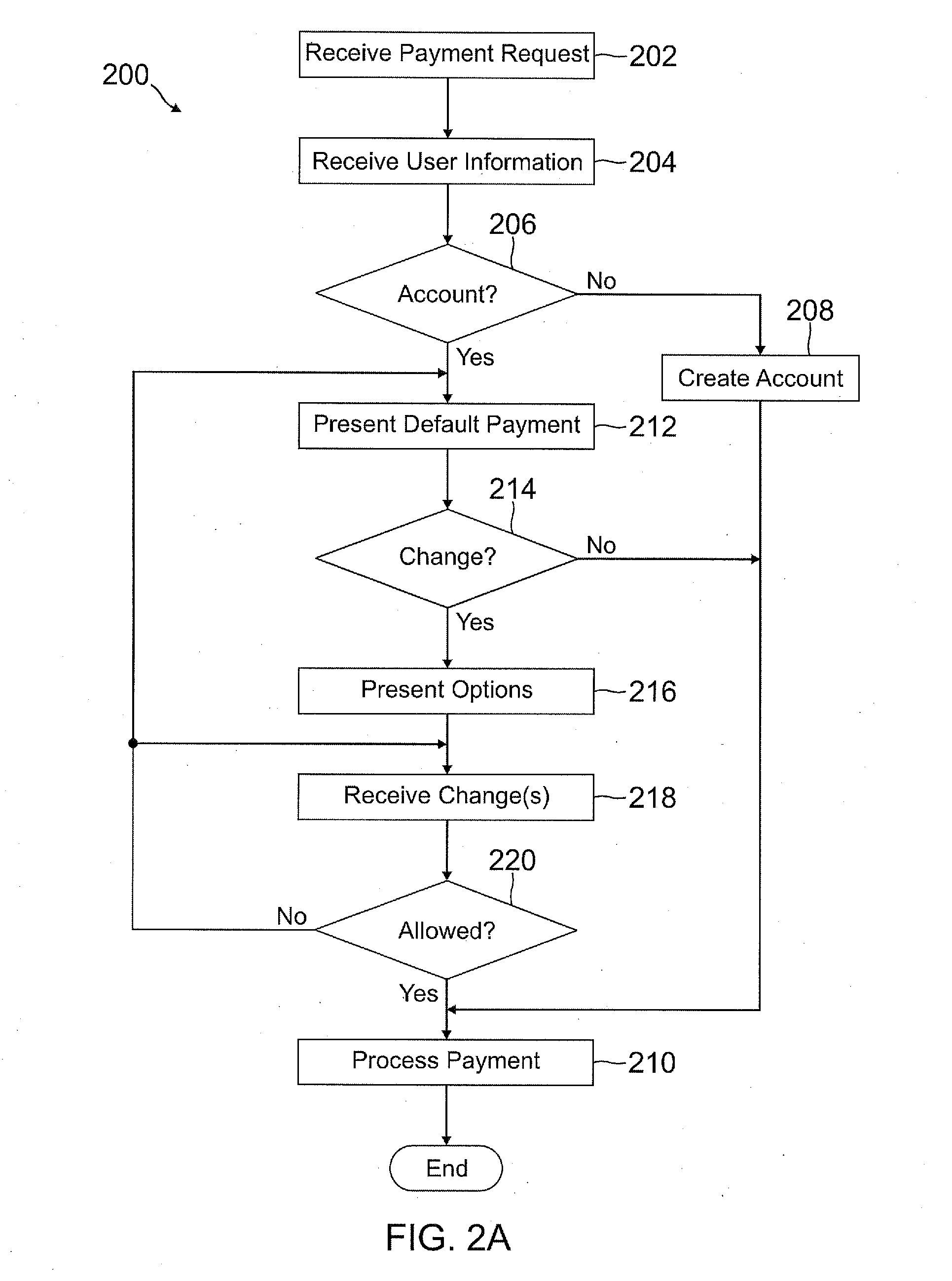

Deferred payment and selective funding and payments

InactiveUS20120166311A1Increase flexibilityEasy to controlPayment architectureBuying/selling/leasing transactionsPaymentEmail address

A user is able to change one or more payment options after payment has already been made to a merchant. A payment provider processes a payment request during a transaction with the merchant with default or selected payment options. After the transaction with the merchant is completed and the merchant has been paid, the user may change one or more of the payment options, such as funding source(s) and terms / conditions of payment (e.g., deferment period, installment period / amount, etc.). During the transaction, the user may make a purchase through the payment provider even if the user does not have an account with the payment provider by providing user information, such as name, address, phone number, email address, and date of birth, but not a social security number or funding source information.

Owner:PAYPAL INC

Bill Payment Card Method and System

The invention is directed to a system and method for managing a payment system. The method generally comprises activating a payment card, associating a value with the payment card, associating at least one third party with the bill payment card, receiving a request from a bill payment card user to transfer at least some of the value to a selected third party, the request comprising receiving an identifier associated with the payment card and receiving an indication of an amount of value to transfer, and transferring at least some of the value to the selected third party. Systems of the invention may generally comprise one or more payment cards, a database storing a plurality of records comprising information related to the payment card; one or more communication devices; and a processor in communication with the database and in selective communication with the communication device.

Owner:E2INTERACTIVE INC D B A E2INTERACTIVE

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com