Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

126 results about "Funding source" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

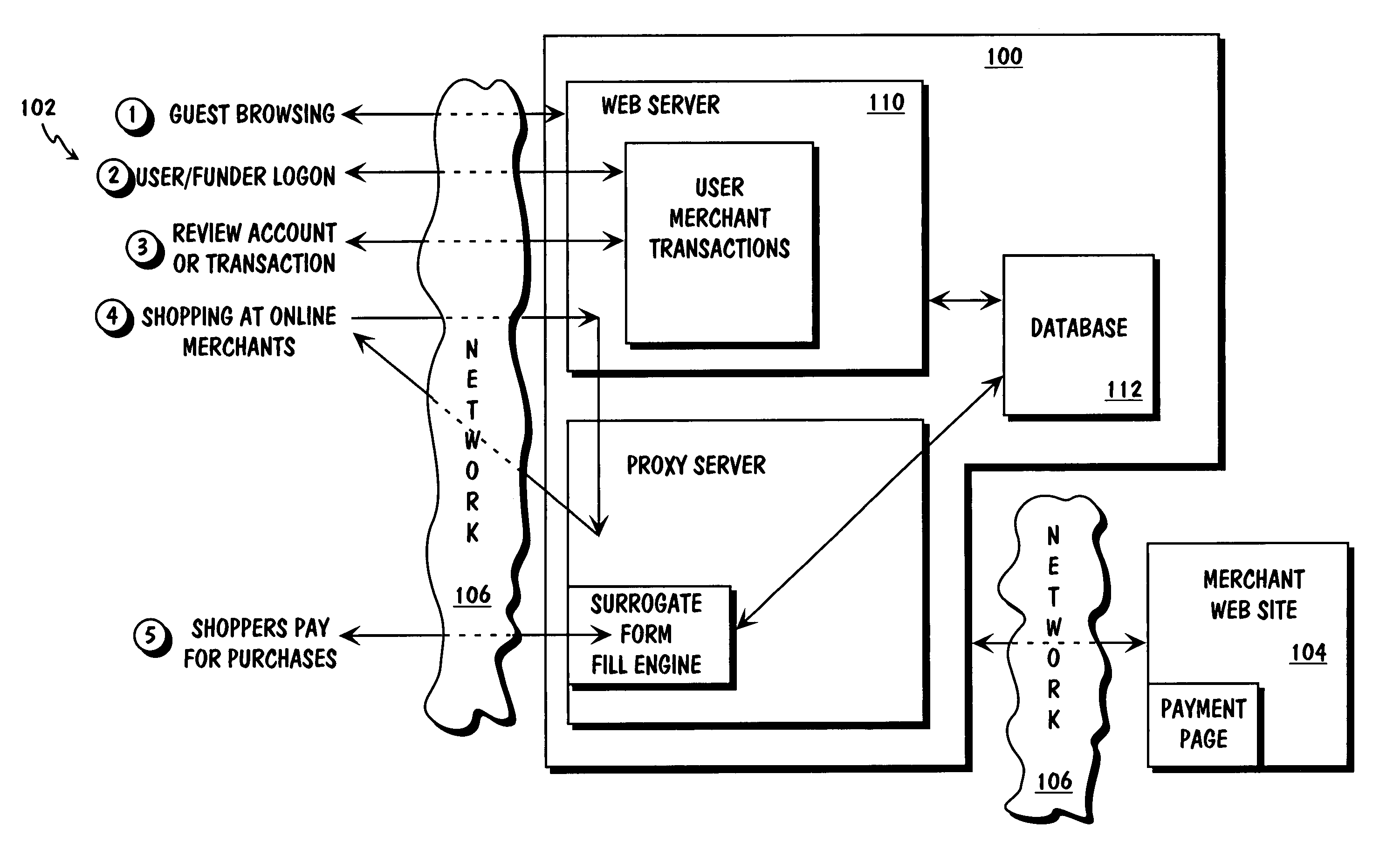

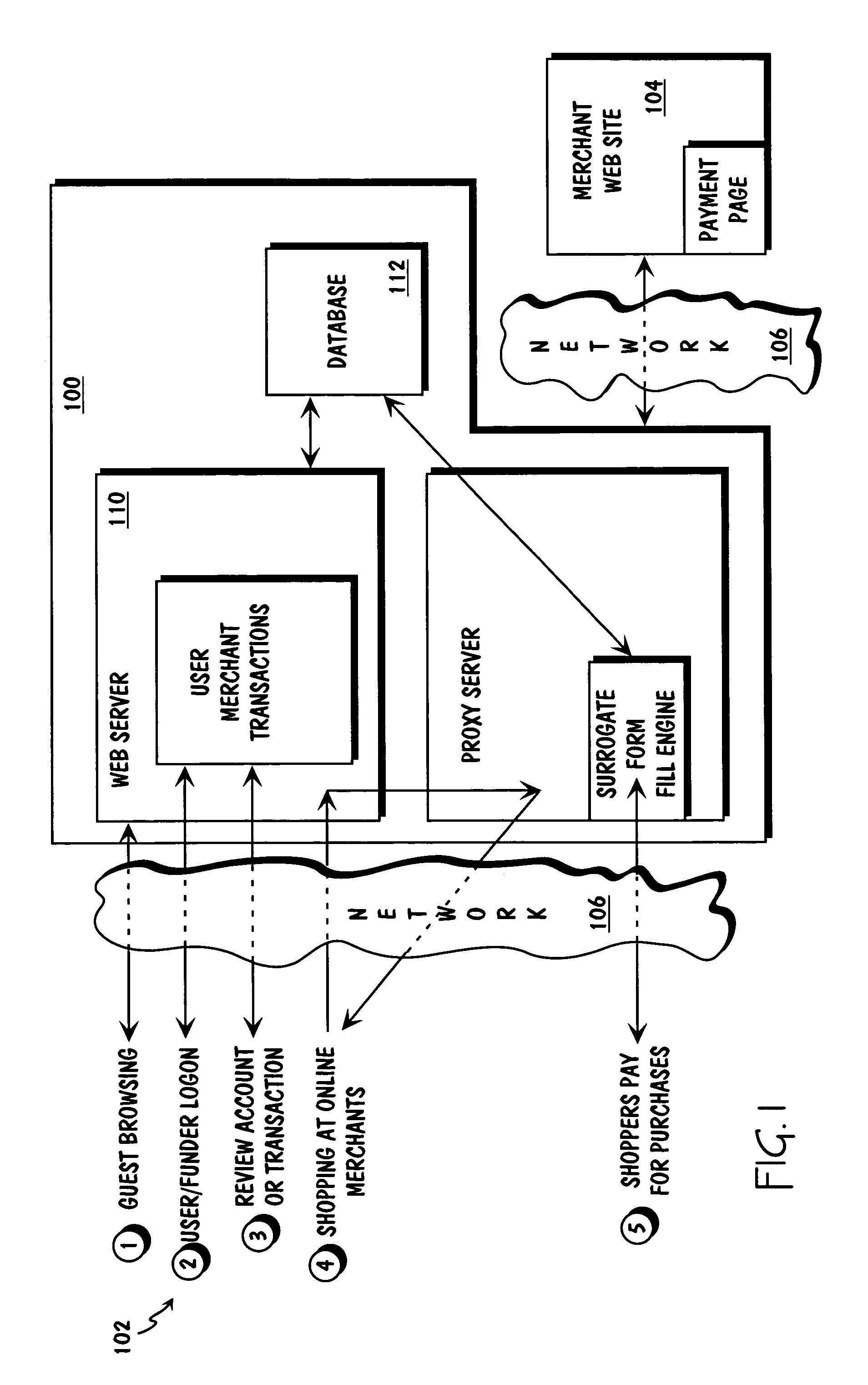

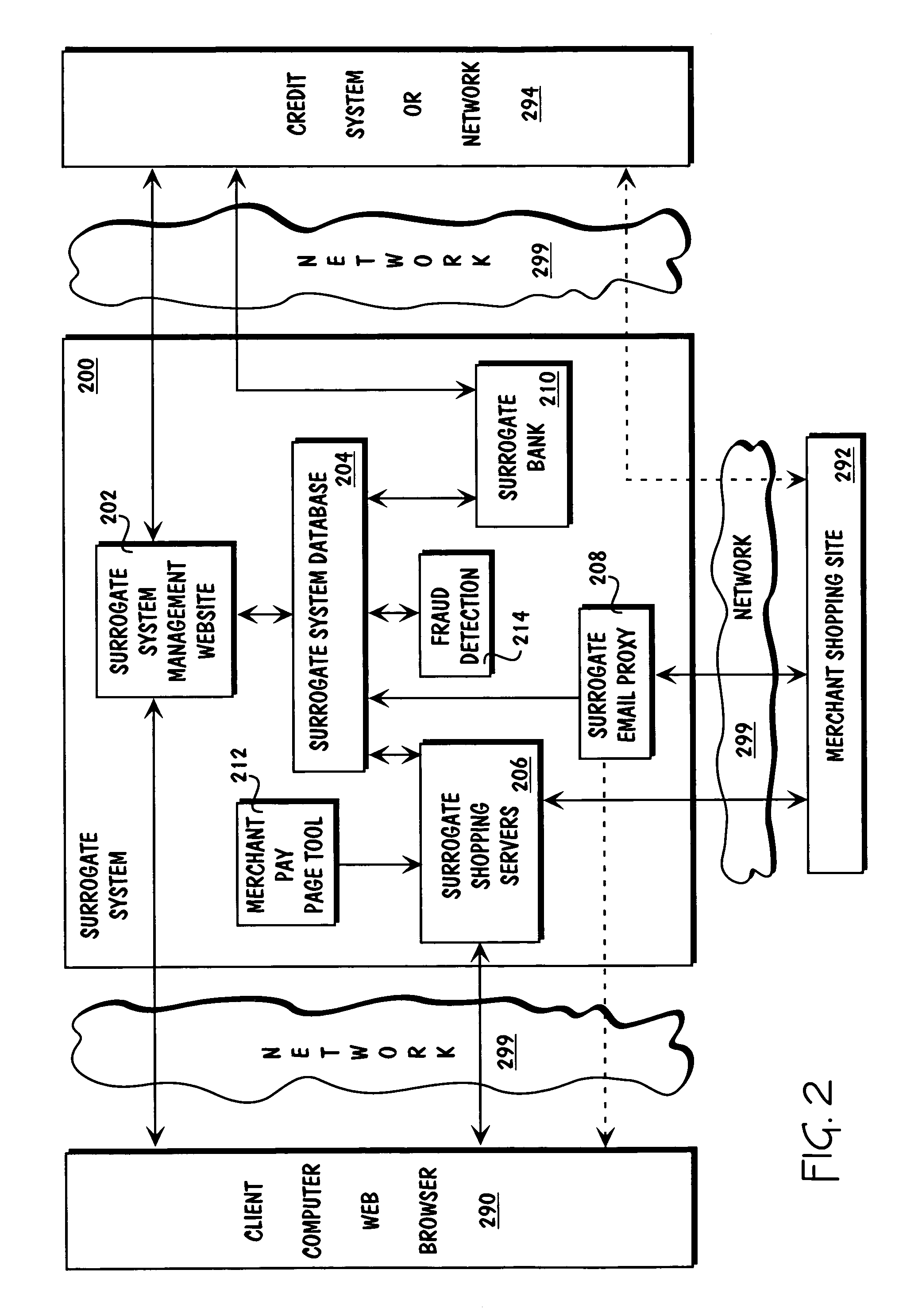

Method and apparatus for surrogate control of network-based electronic transactions

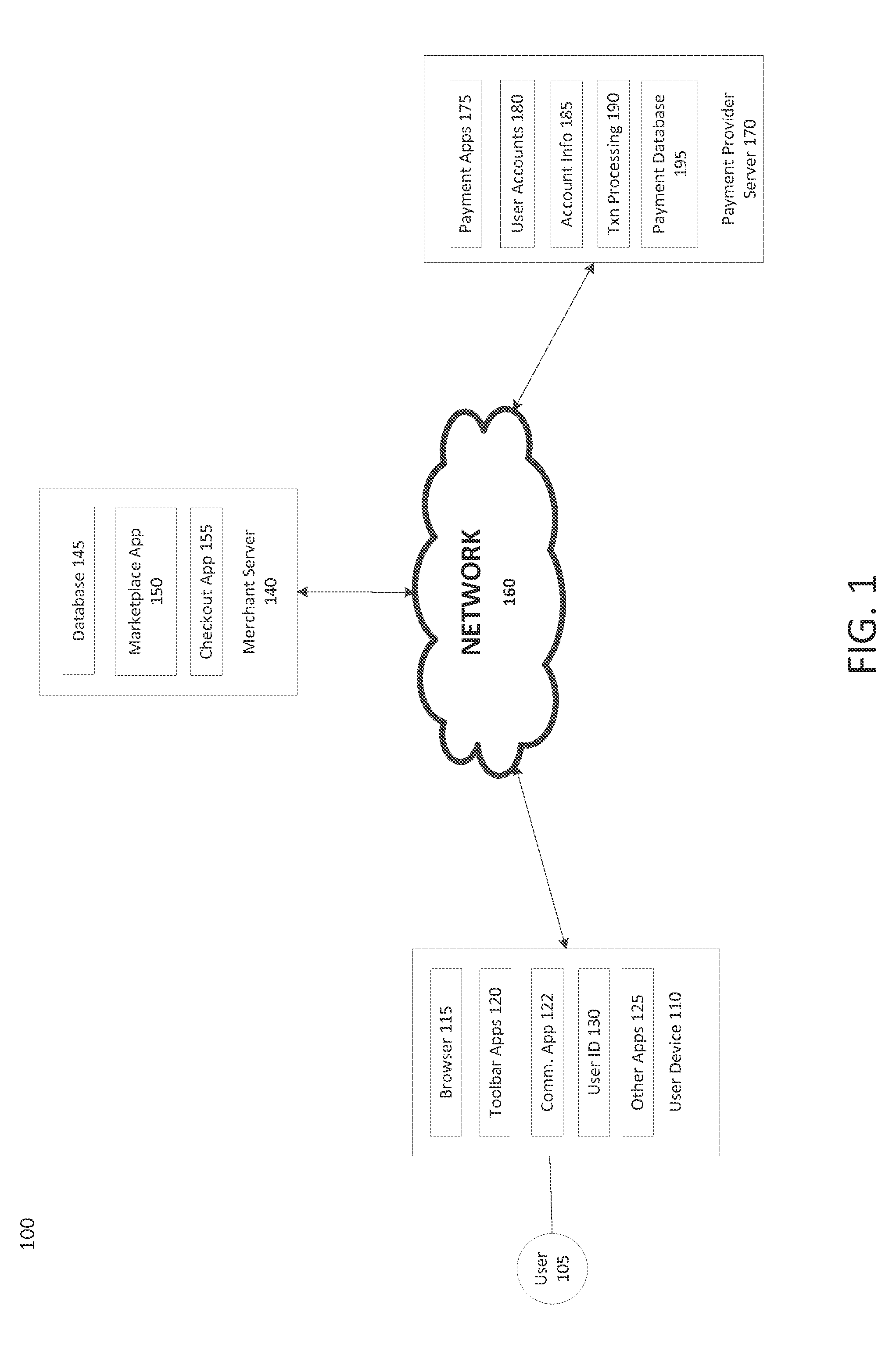

A surrogate system for the transparent control of electronic commerce transactions is provided through which an individual without a credit card is enabled to shop at online merchant sites. Upon opening an account within the surrogate system, the account can be funded using numerous fund sources, for example credit cards, checking accounts, money orders, gift certificates, incentive codes, online currency, coupons, and stored value cards. A user with a funded account can shop at numerous merchant web sites through the surrogate system. When merchandise is selected for purchase, a purchase transaction is executed in which a credit card belonging to the surrogate system is temporarily or permanently assigned to the user. The credit card, once loaded with funds from the user's corresponding funded account, is used to complete the purchase transaction. The surrogate system provides controls that include monitoring the data streams and, in response, controlling the information flow between the user and the merchant sites.

Owner:THE COCA-COLA CO

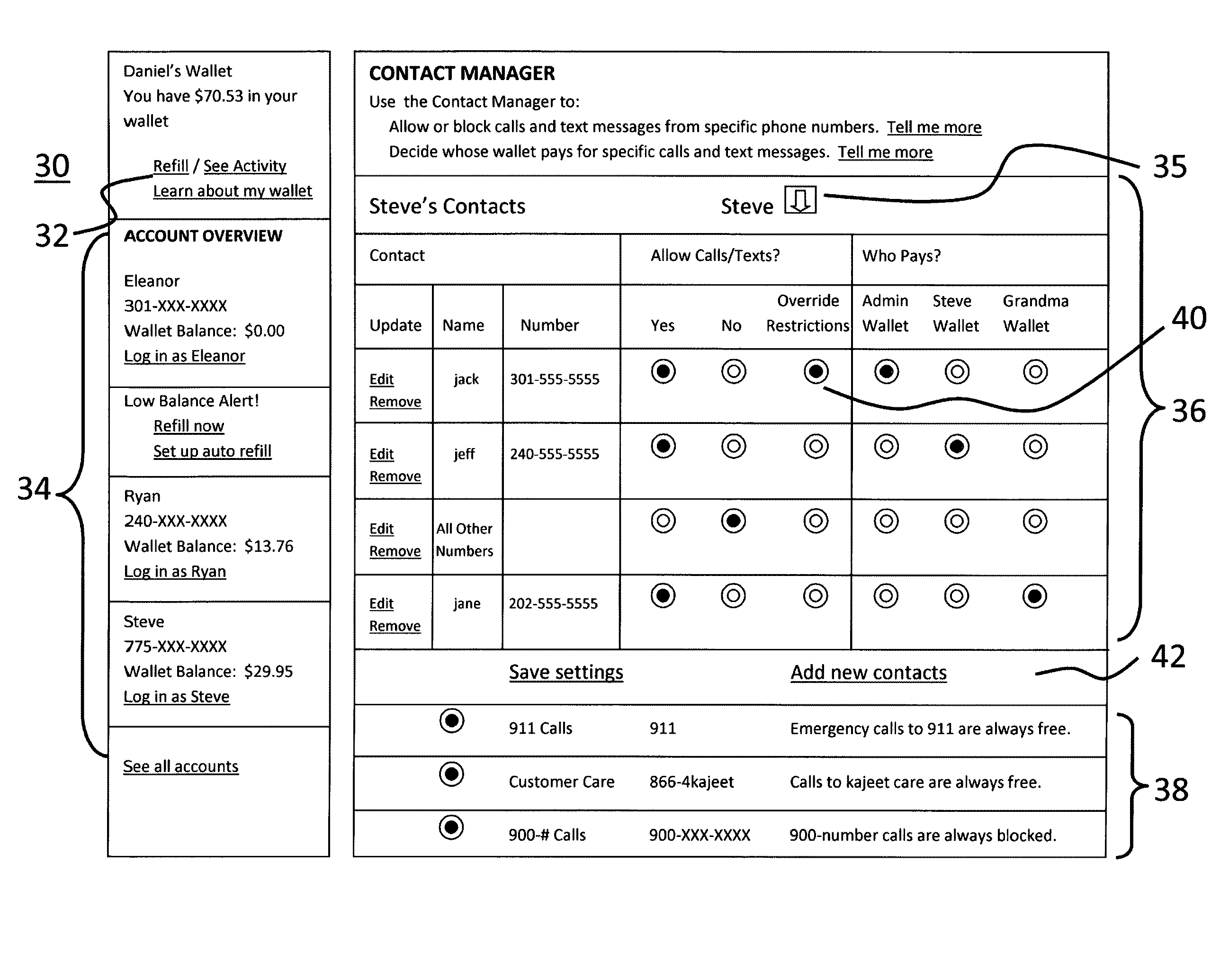

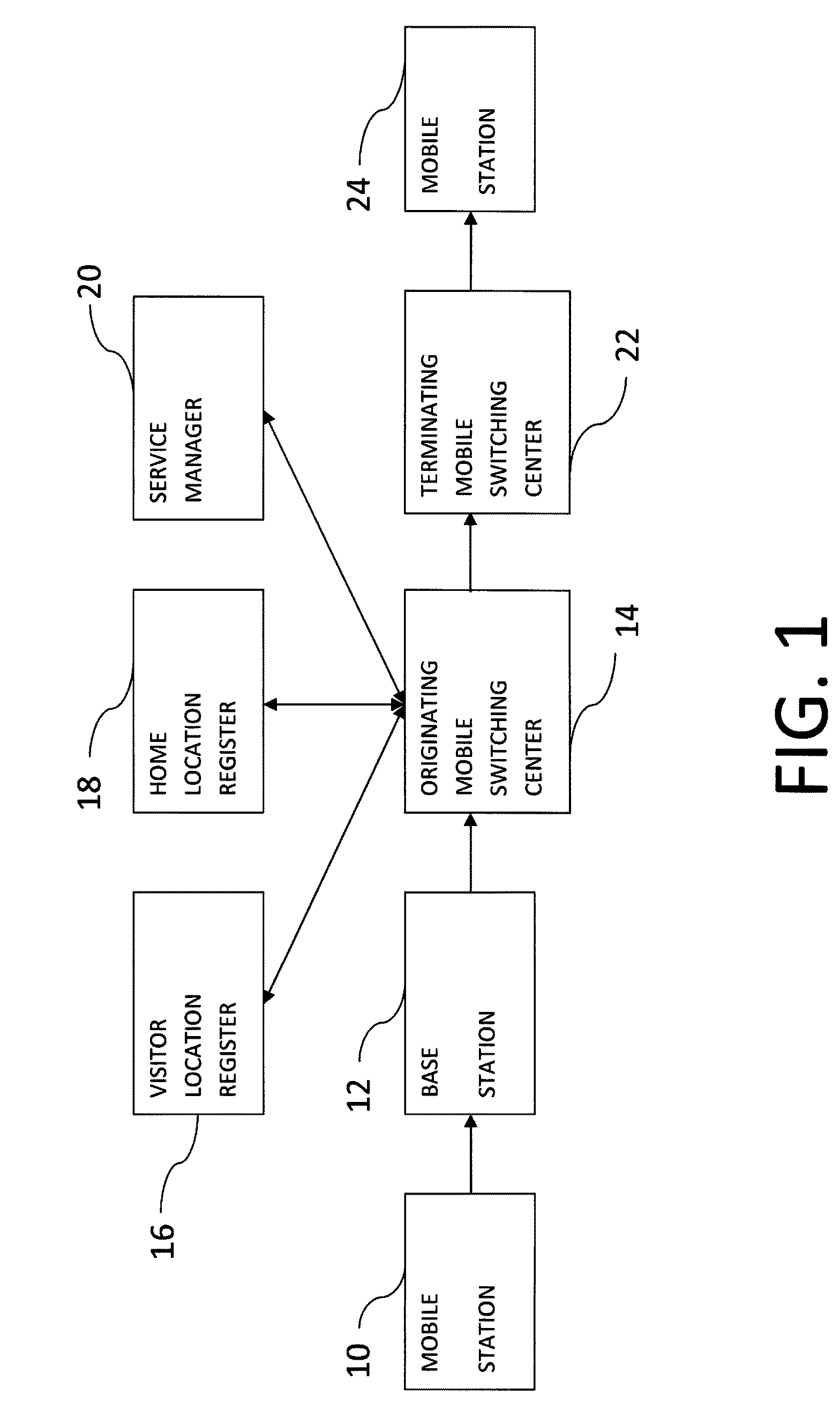

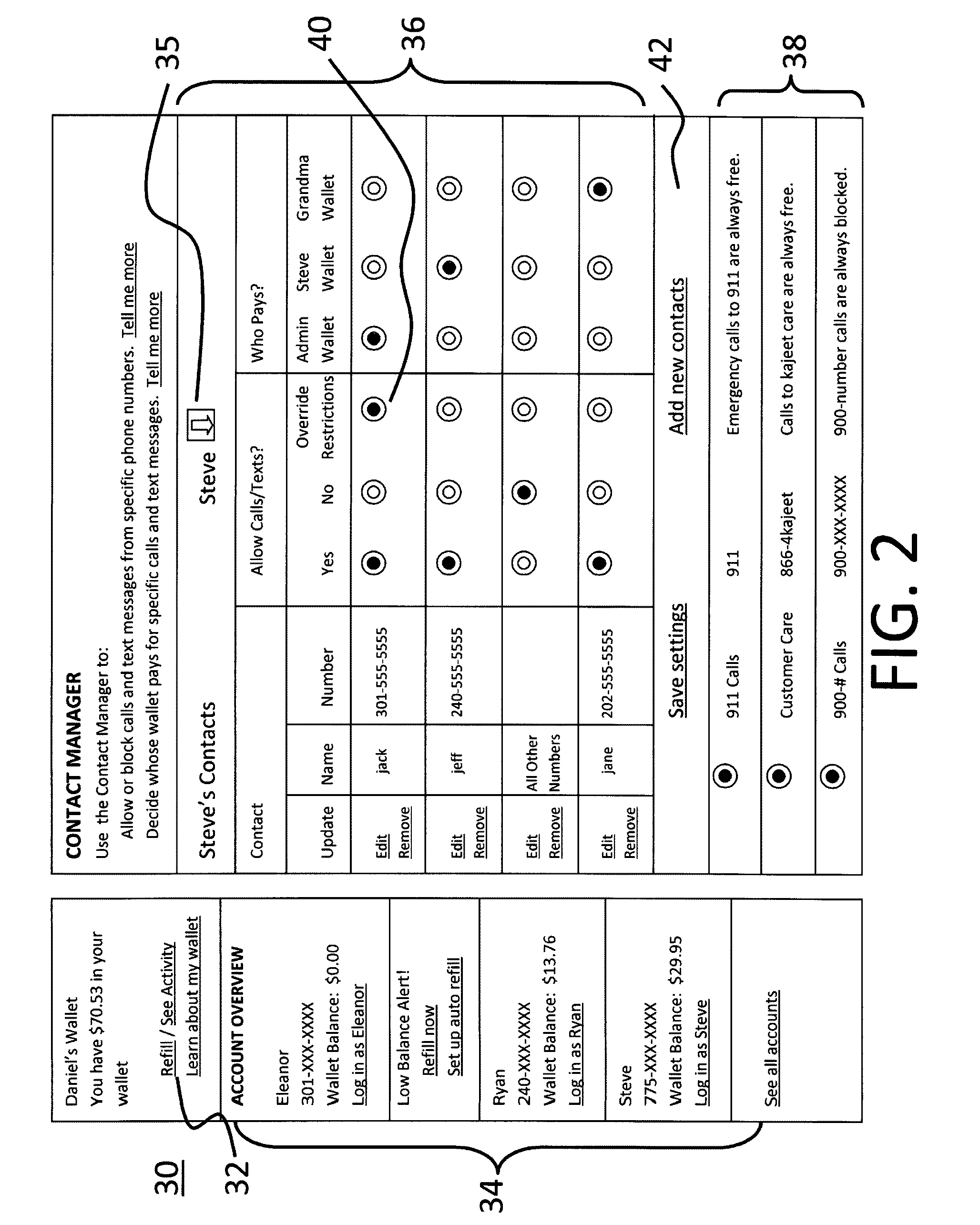

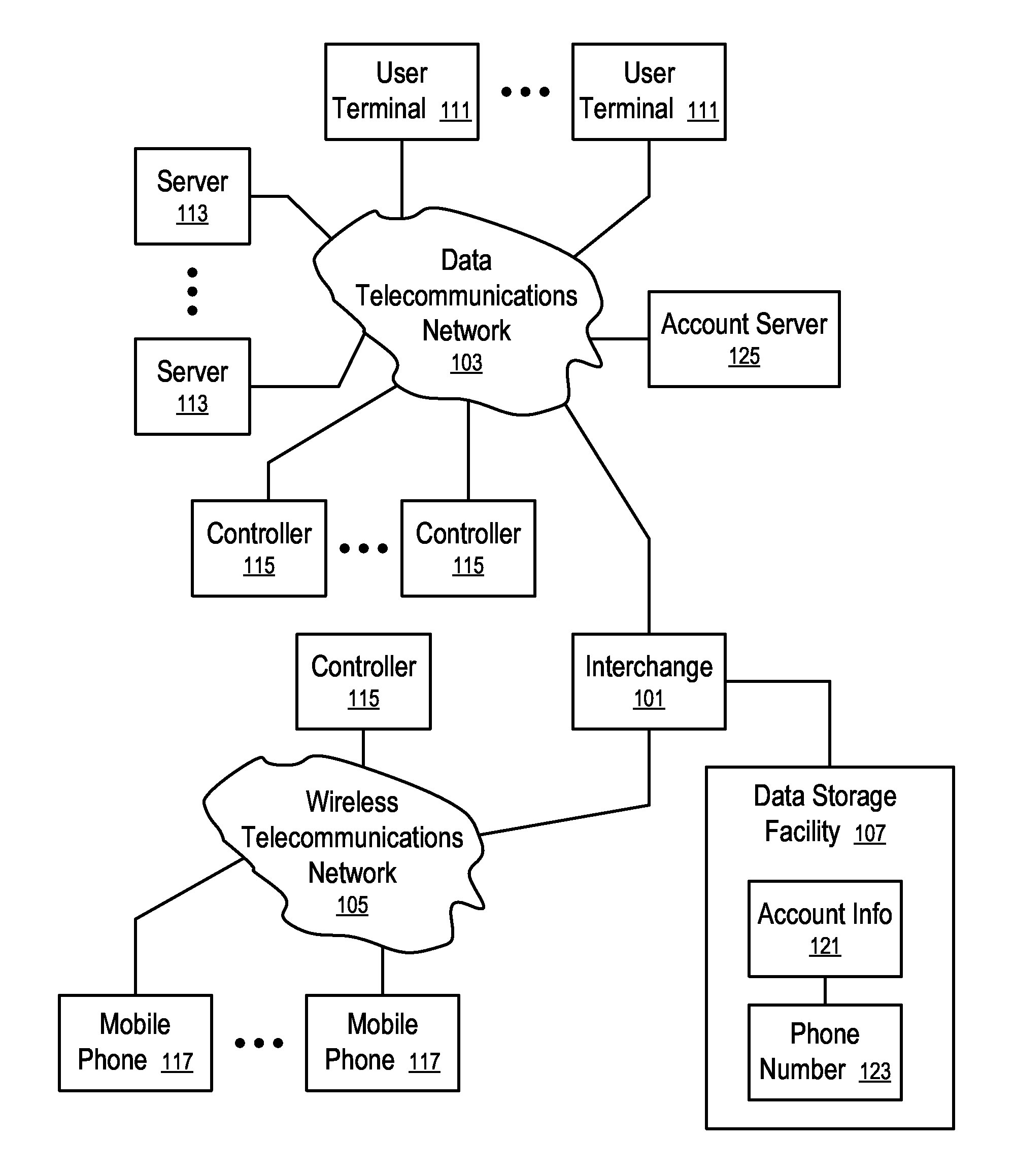

System and methods for managing the utilization of a communications device

A system and method for the real-time management of a device, and more particularly to the allocation of electronic wallets that are associated with one or more devices and various controls that enable at least two entities to manage how the device is utilized for various activities and to pay for goods and services. Each device is associated with at least two electronic wallets, a user wallet and an administrator wallet. The administrator can establish rules that designate how and when the device can be used and which wallet will be used to pay for goods and services desired by the user, but in the event the user wallet is depleted or low on funds, the administrator wallet can serve as a backup funding source for specified types of goods and / or services. Additional wallets can also be associated with the device to authorize and pay for goods and services, under the control of the administrator wallet, such as a promotional wallet that could be designated for use with the device before a primary or administrative wallet was used, or a dynamic wallet that could be associated for use with multiple different devices as well as other wallets, but acts in conjunction with the user and administrator wallets. Additional rules can be established to perform many other functions, such as manage the movement of value between wallets and from other sources to the wallets.

Owner:KAJEET

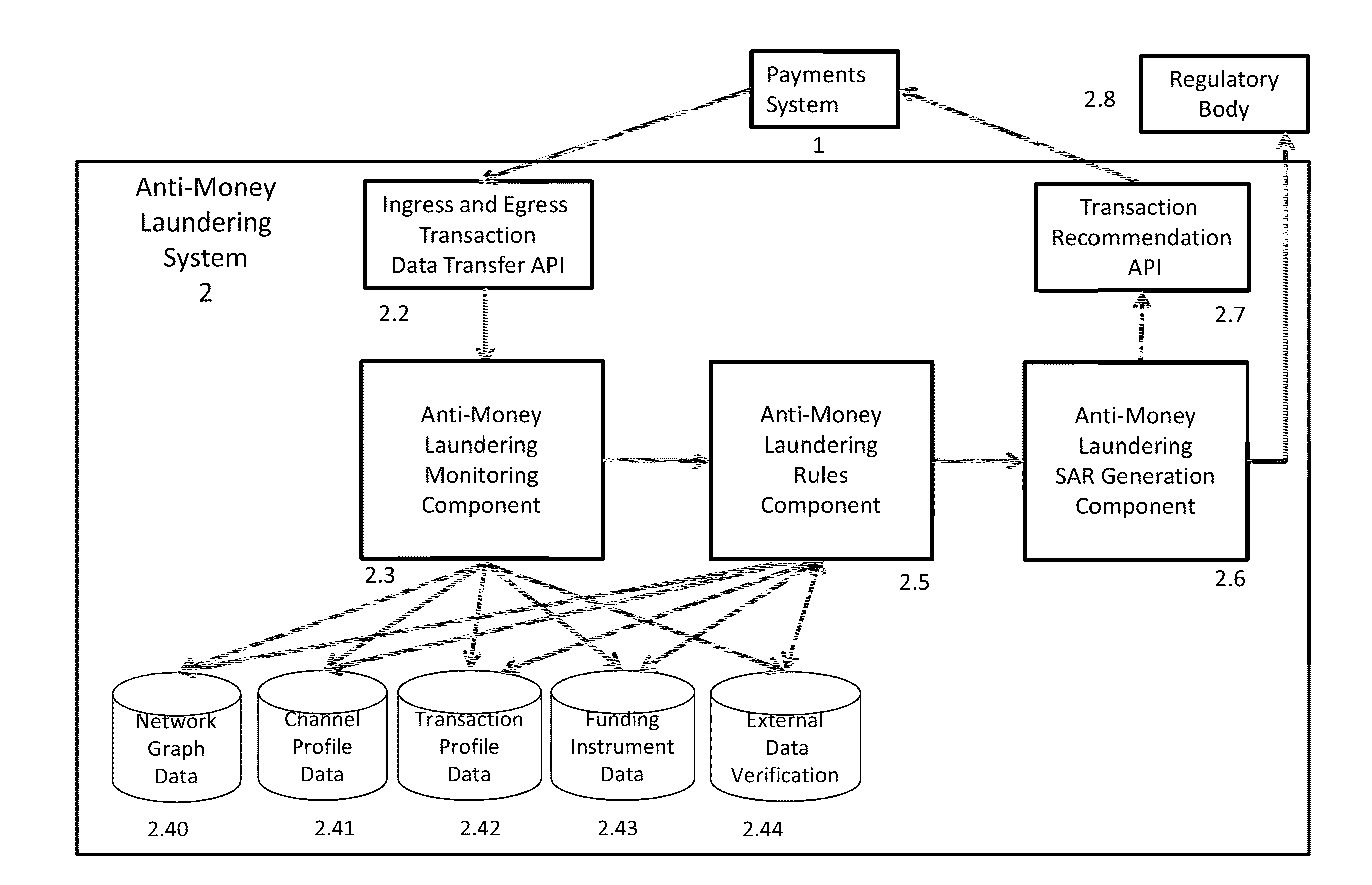

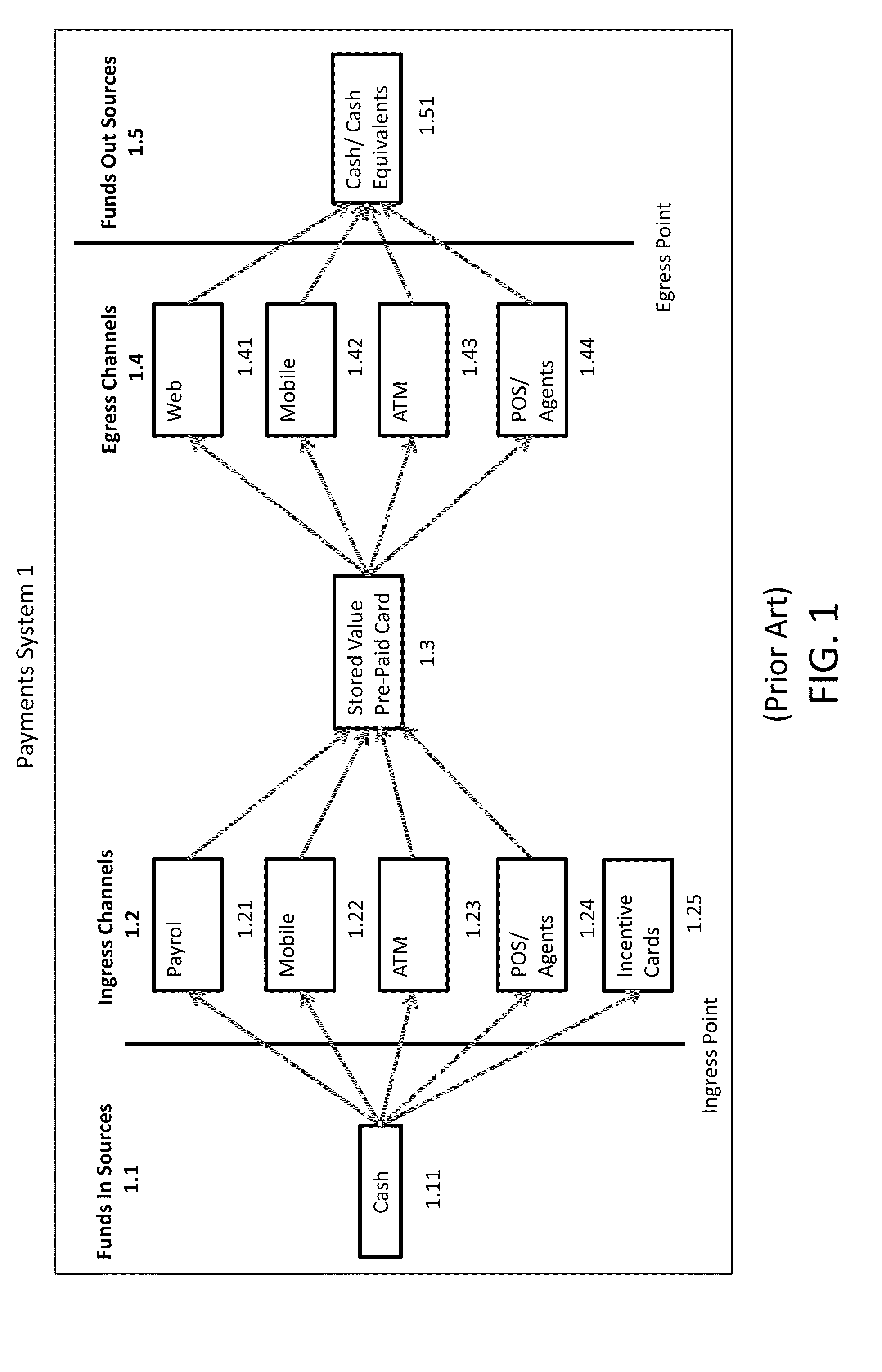

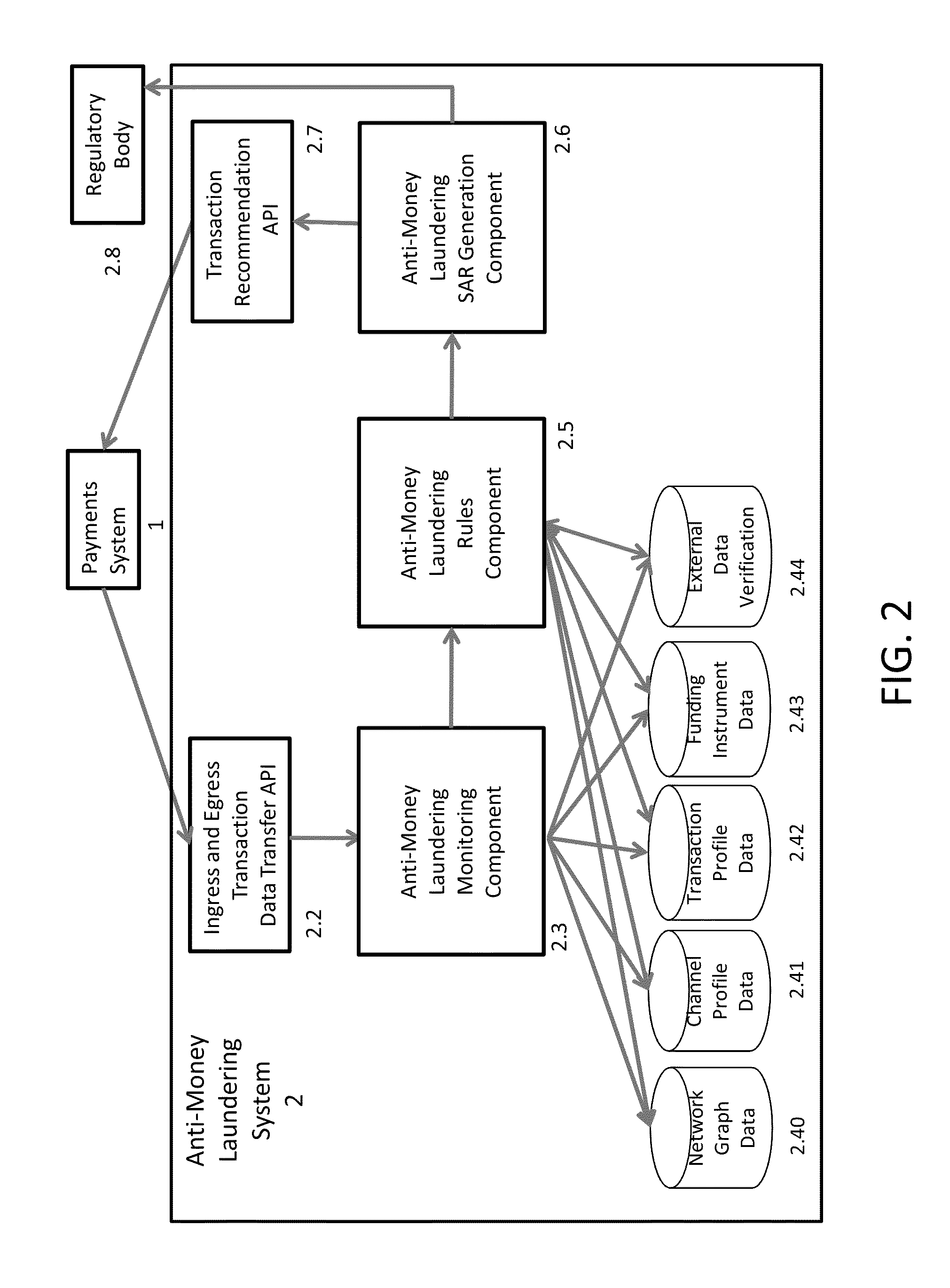

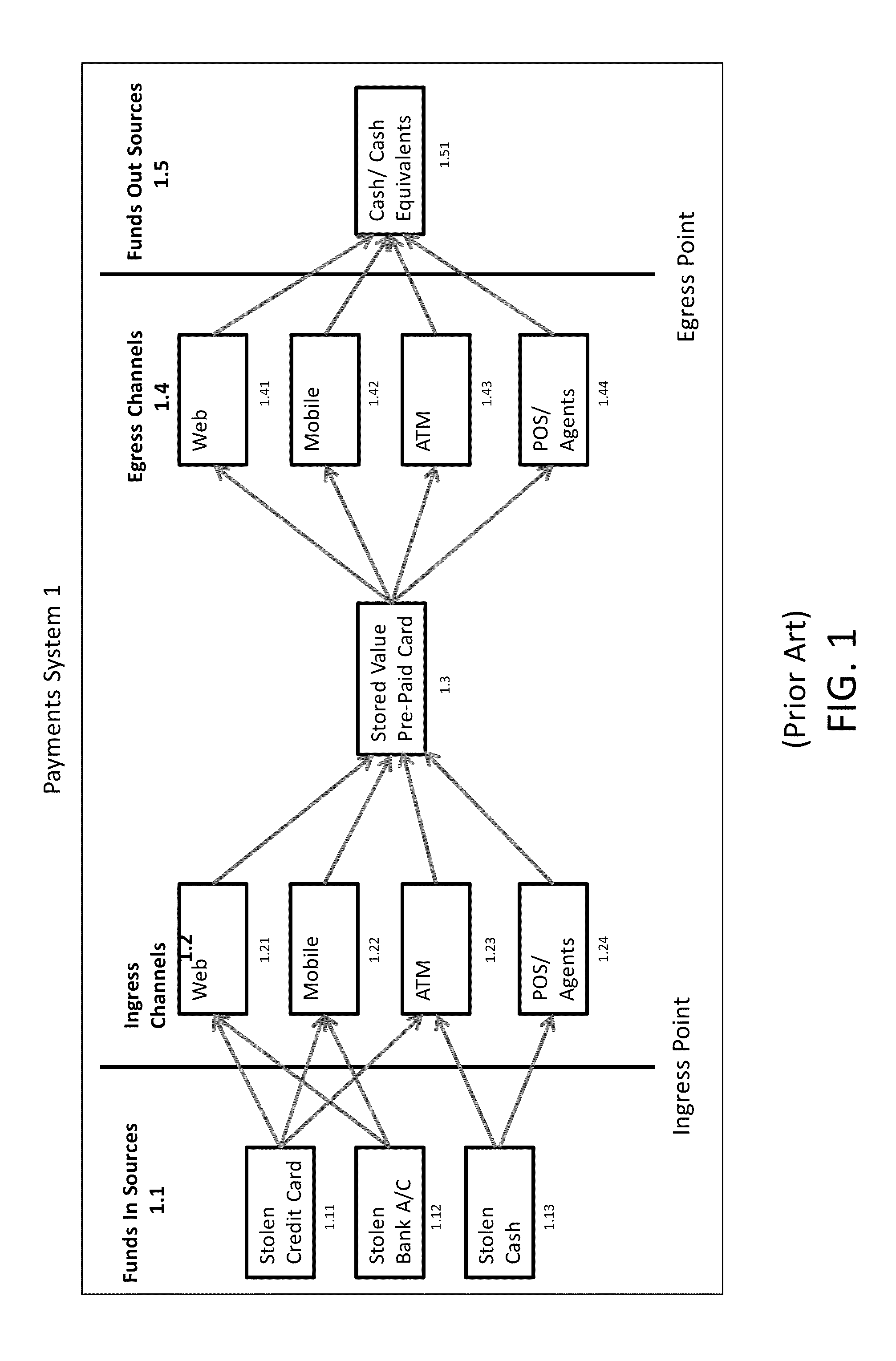

Multi-Channel Data Driven, Real-Time Anti-Money Laundering System For Electronic Payment Cards

Electronic payment card money laundering detection includes receiving real-time payment card transaction data from ingress channels and an egress channels of at least one payment card system through a first API; generating transactional profiles for each of at least payment cards, the ingress channel, the egress channels, and funding sources of the payment cards; in response to receiving transaction data for a current payment card transaction, evaluating the transaction data using a predictive algorithm that compares the transaction data to the transactional profiles to calculate a probabilistic money laundering score for the current transaction; evaluating the probabilistic money laundering score and current transaction data based on a set of rules to generate a suspicious activity report that recommends whether to approve or report the current transaction; and transmitting the suspicious activity report back to the payment card system and transmitting the suspicious activity report to an identified regulatory body.

Owner:WALMART APOLLO LLC

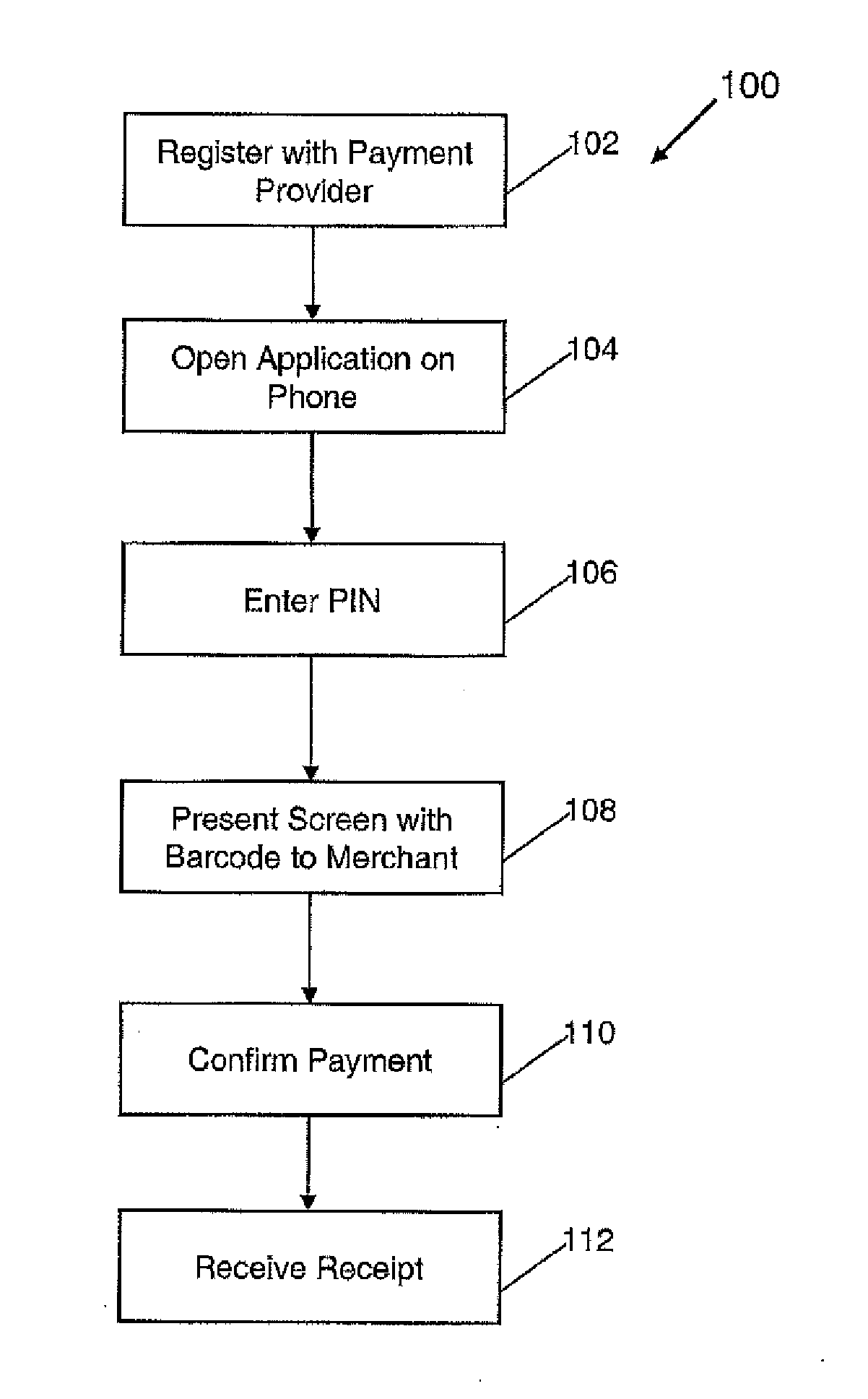

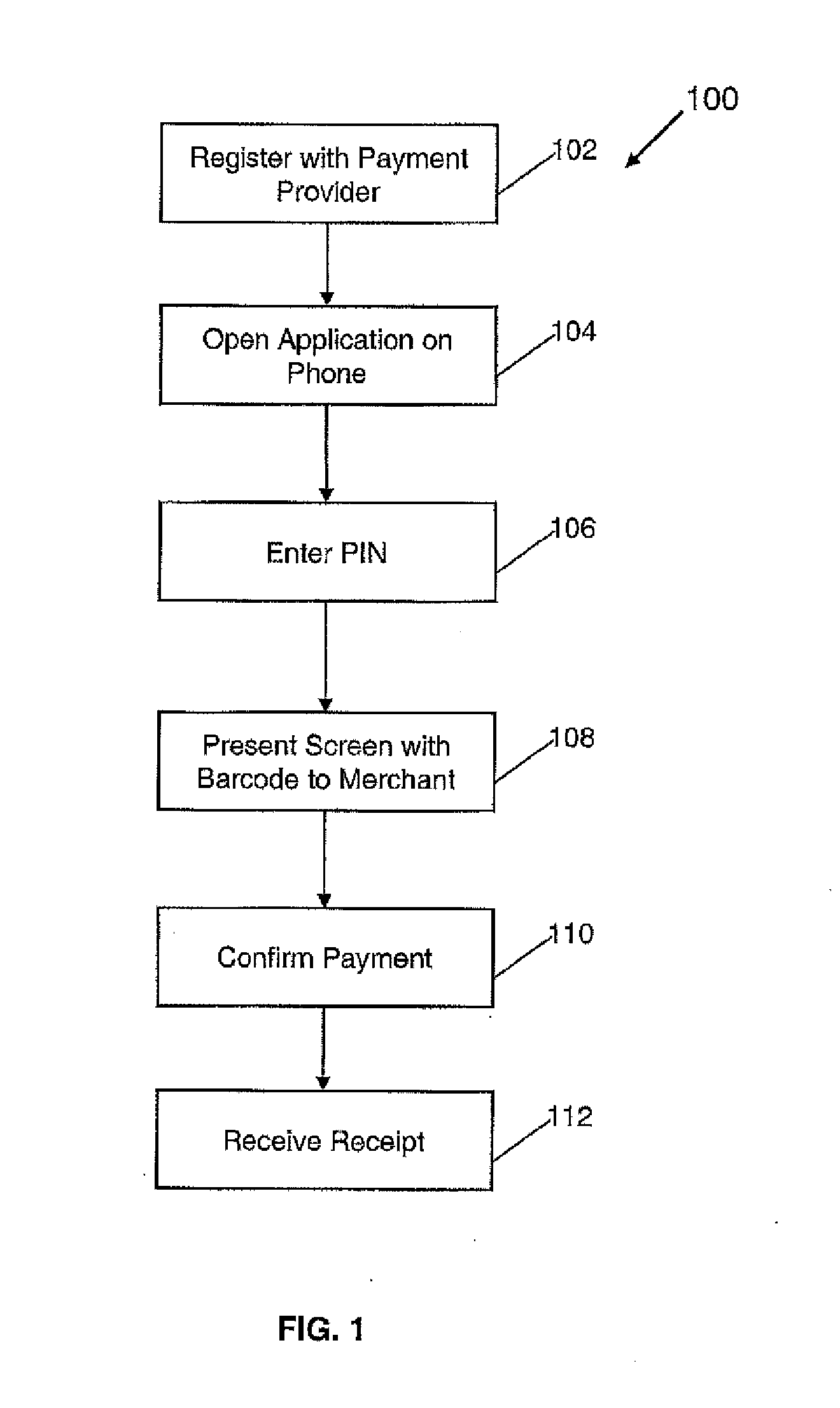

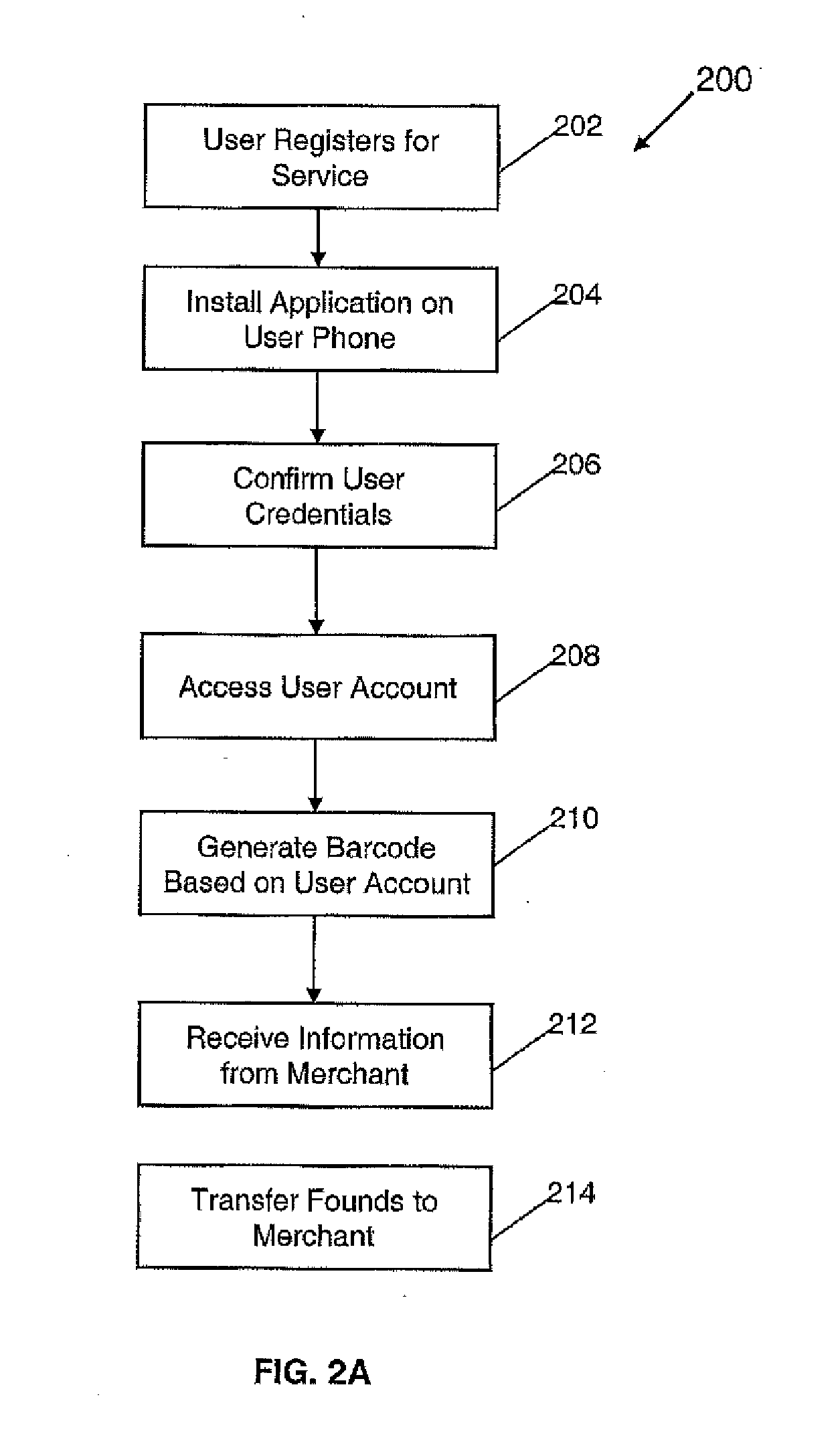

Mobile barcode generation and payment

ActiveUS20120185317A1Easily and safely payIncrease salesComplete banking machinesFinancePaymentDisplay device

An application on user's mobile device (having a display screen) generates a transaction-specific barcode on the display, where the barcode contains a plurality of funding sources for the transaction and / or merchant loyalty, reward, or membership numbers. The barcode can be scanned to make purchases at a point of sale (POS).

Owner:PAYPAL INC

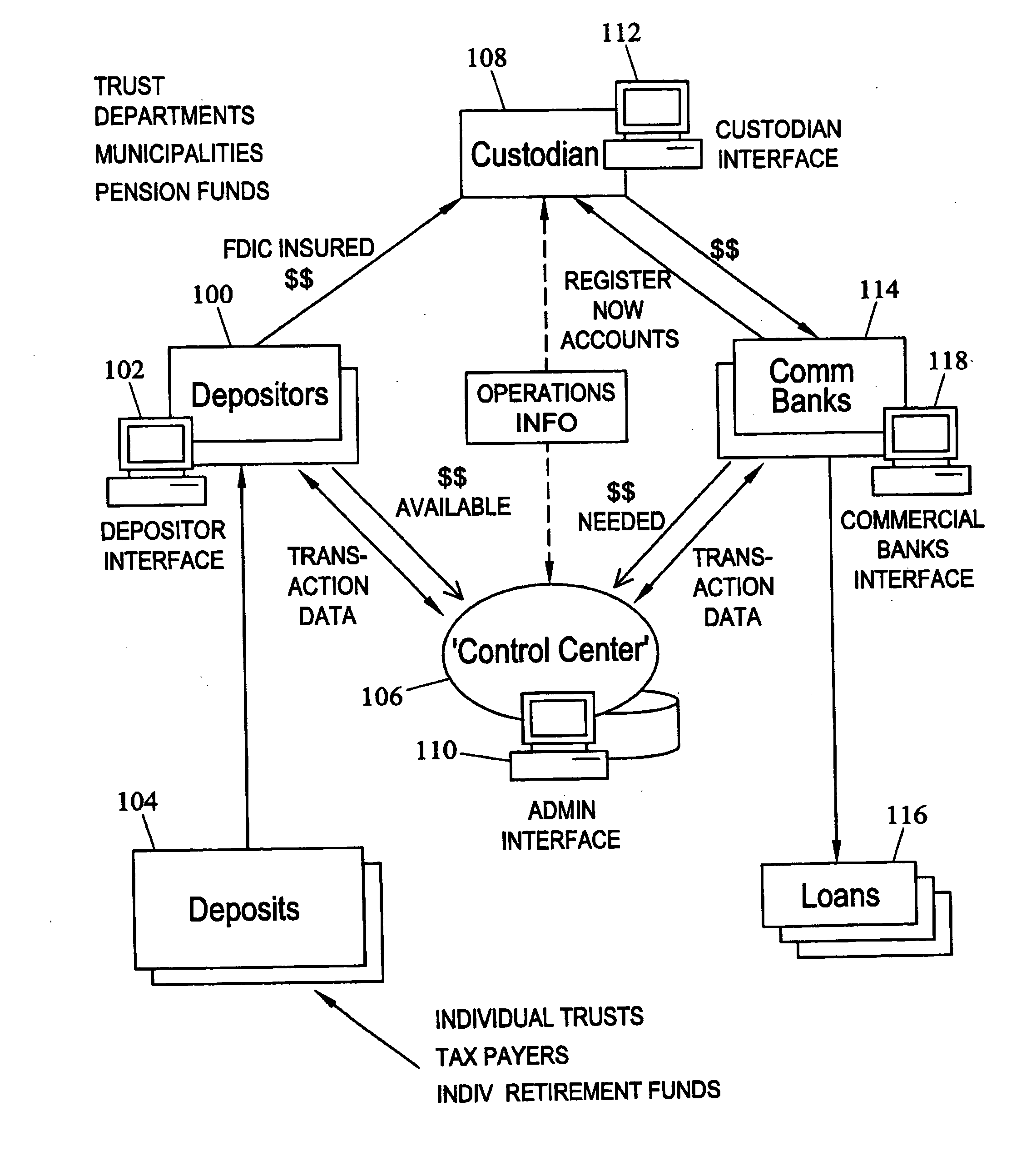

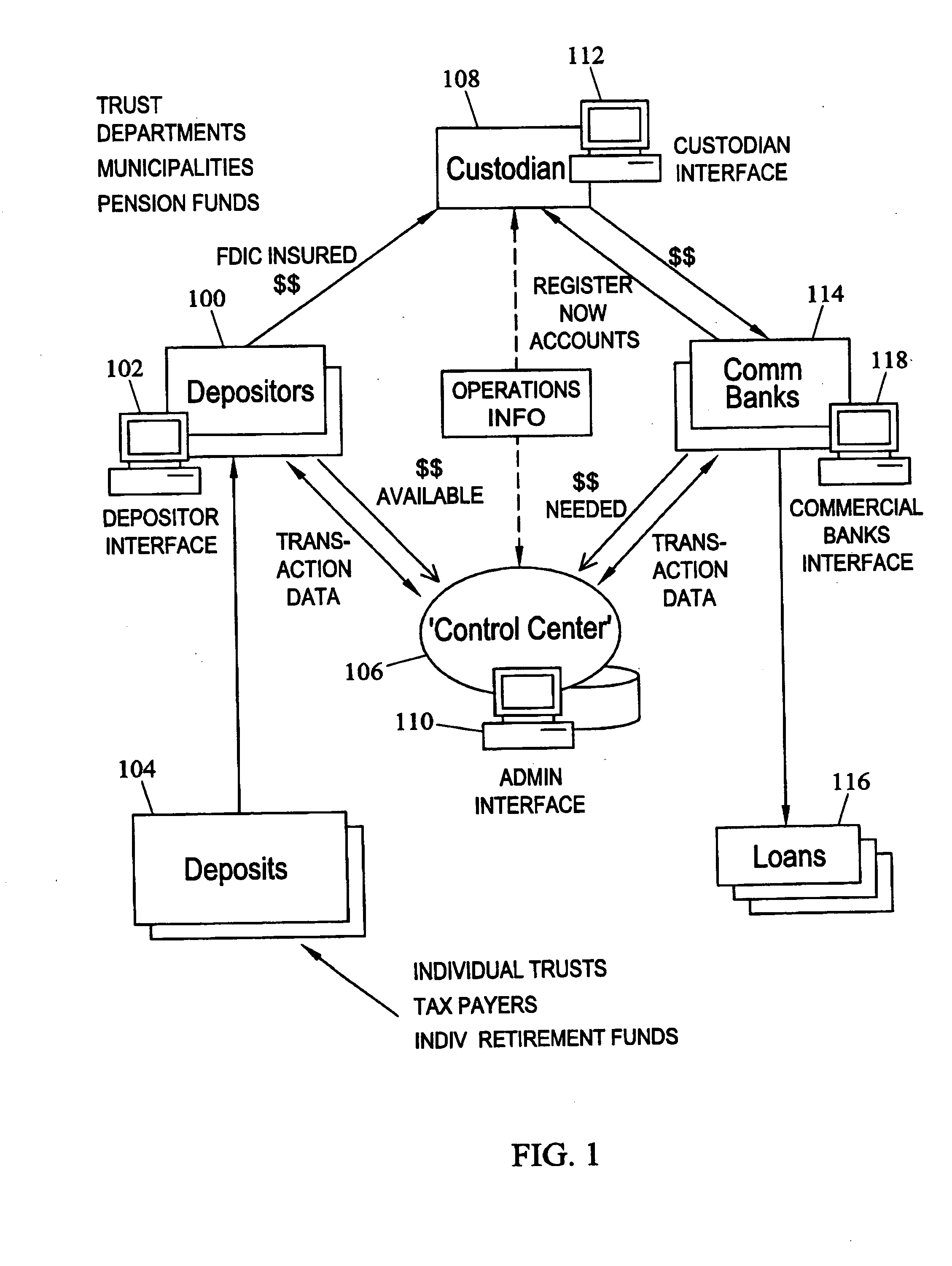

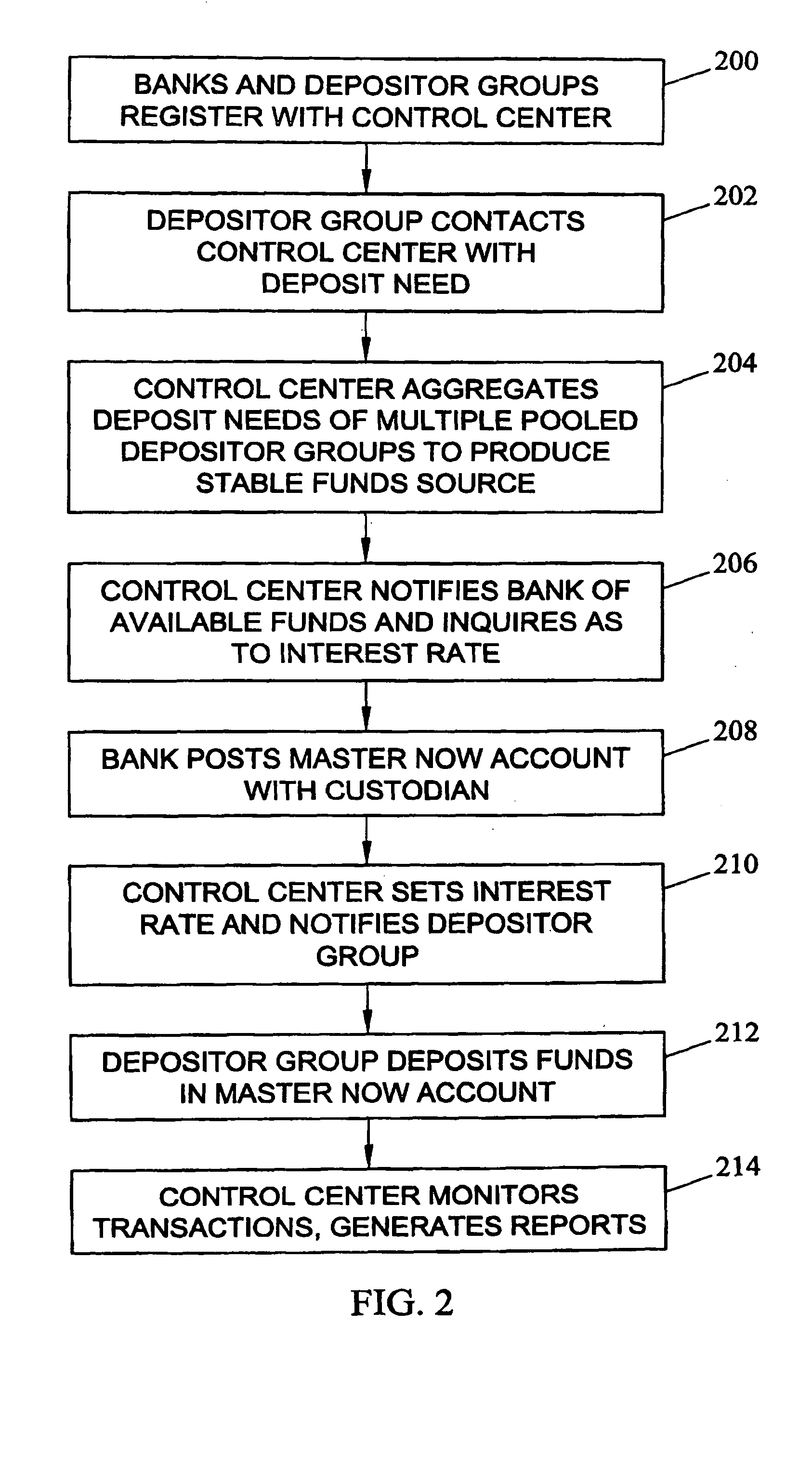

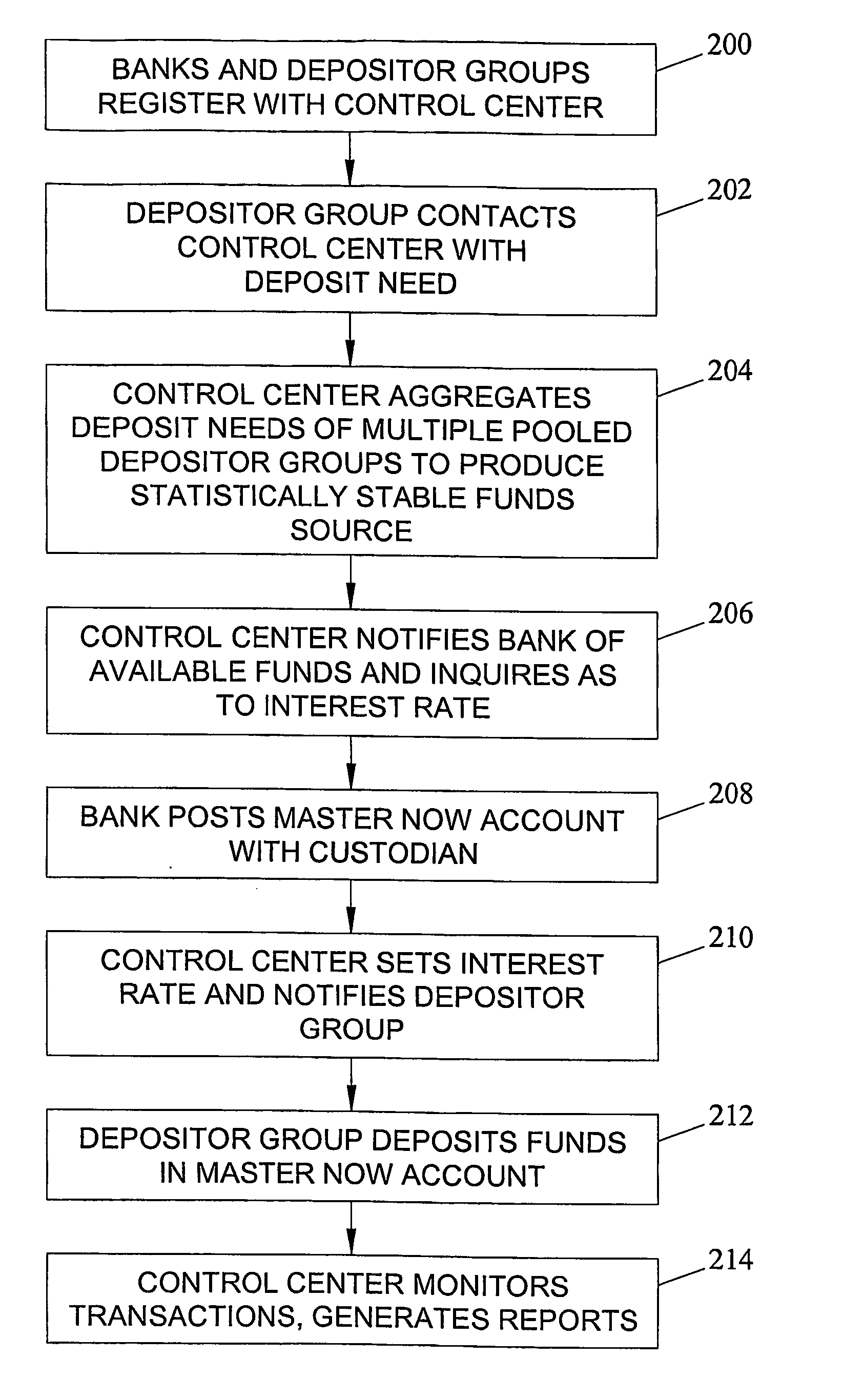

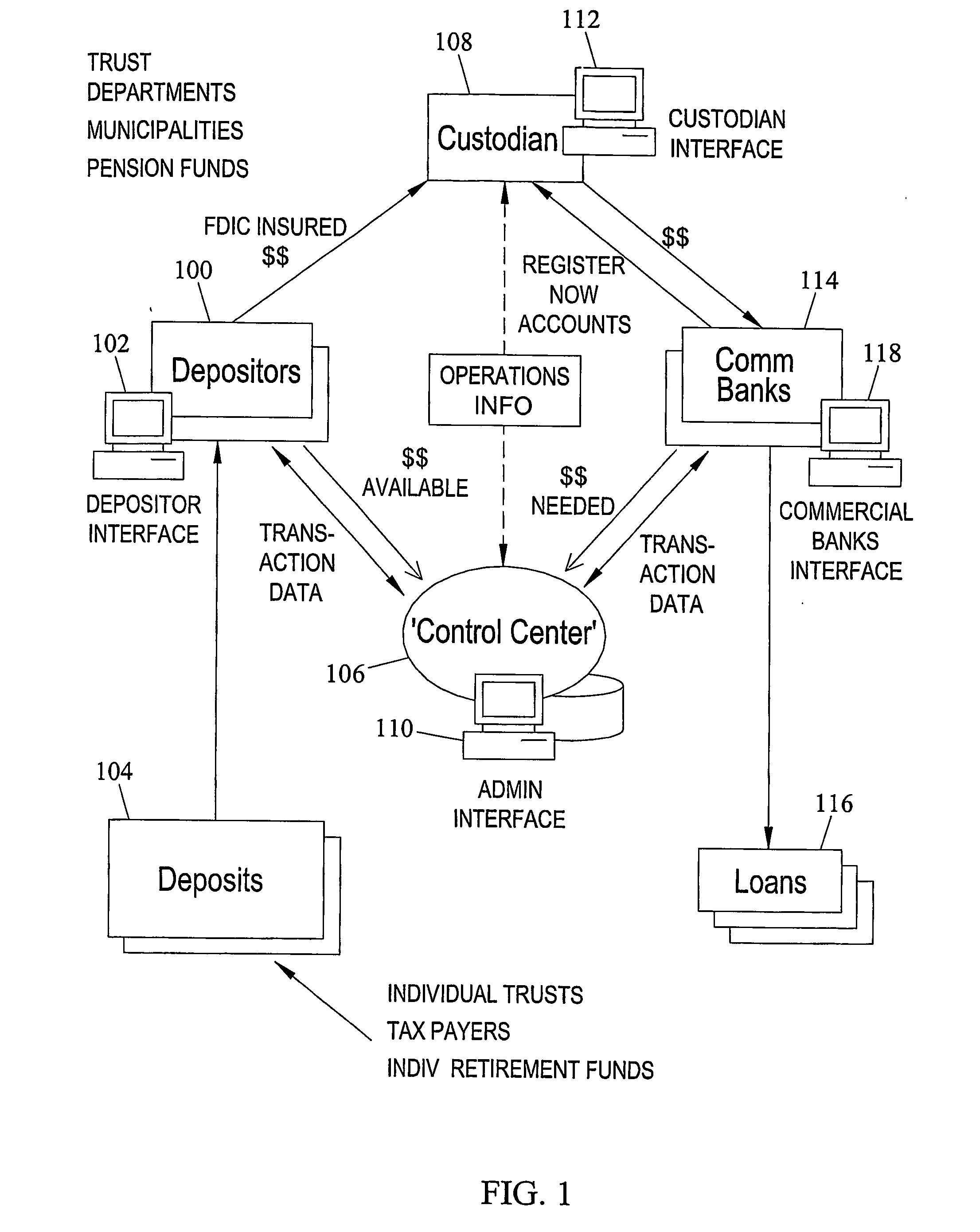

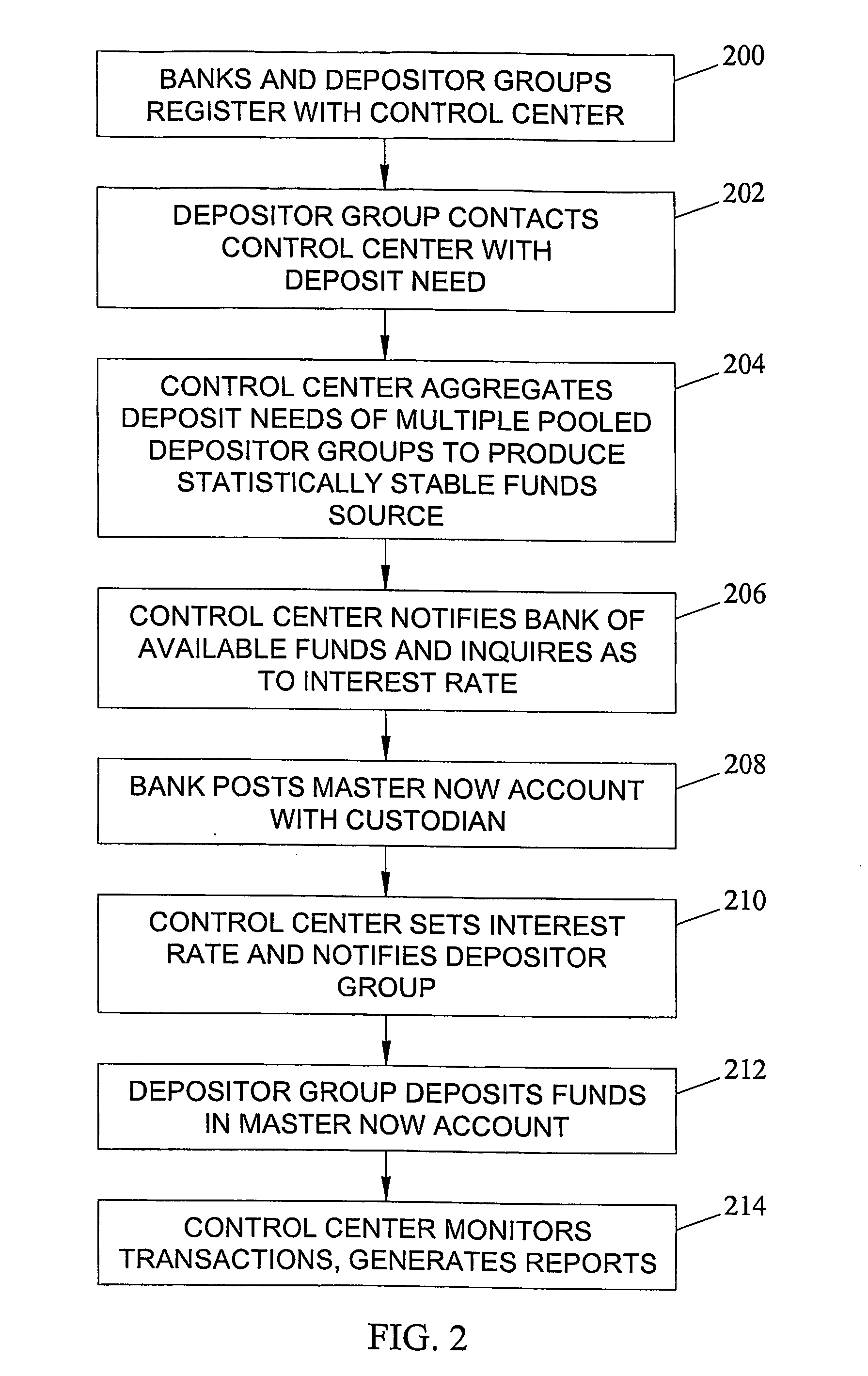

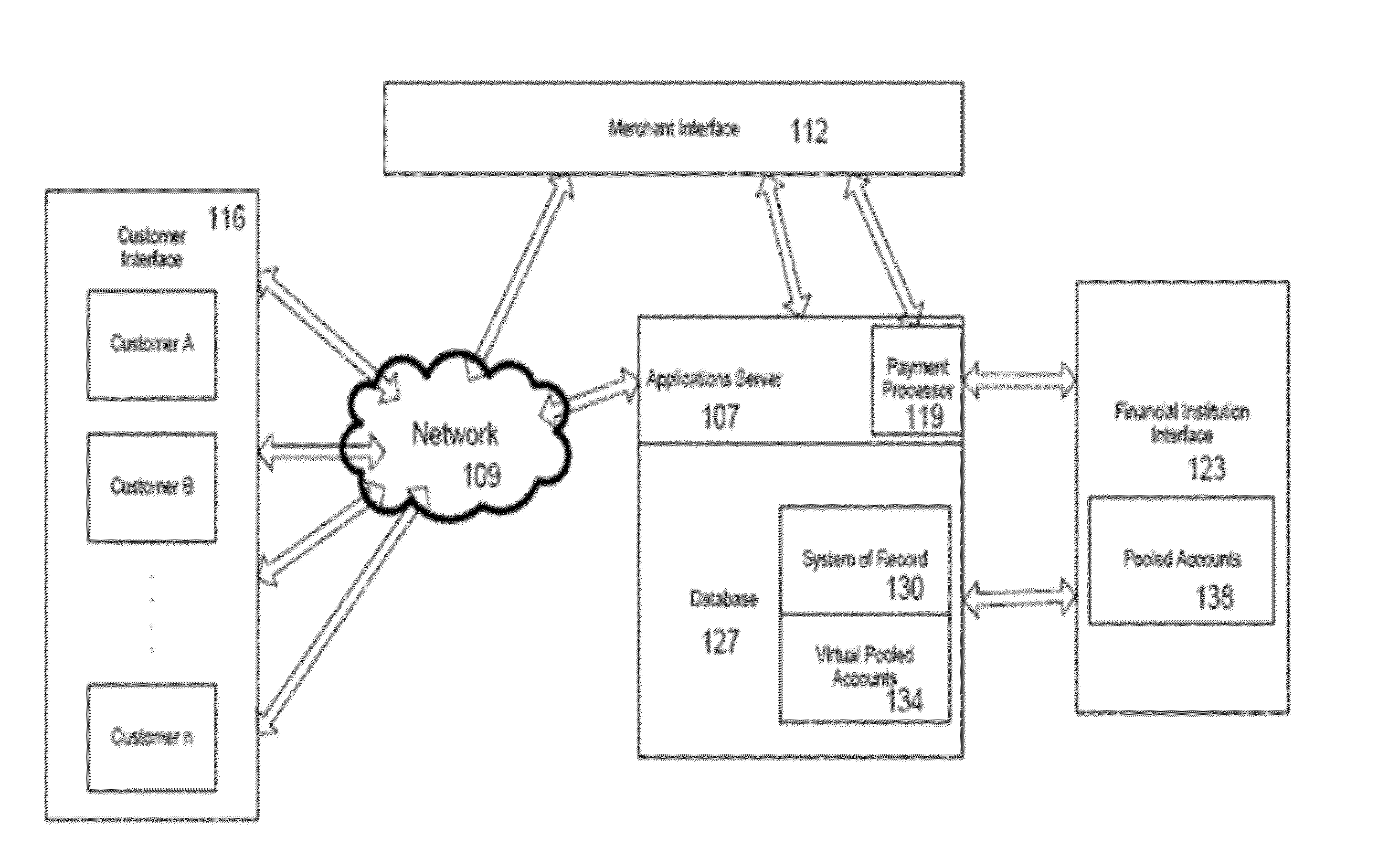

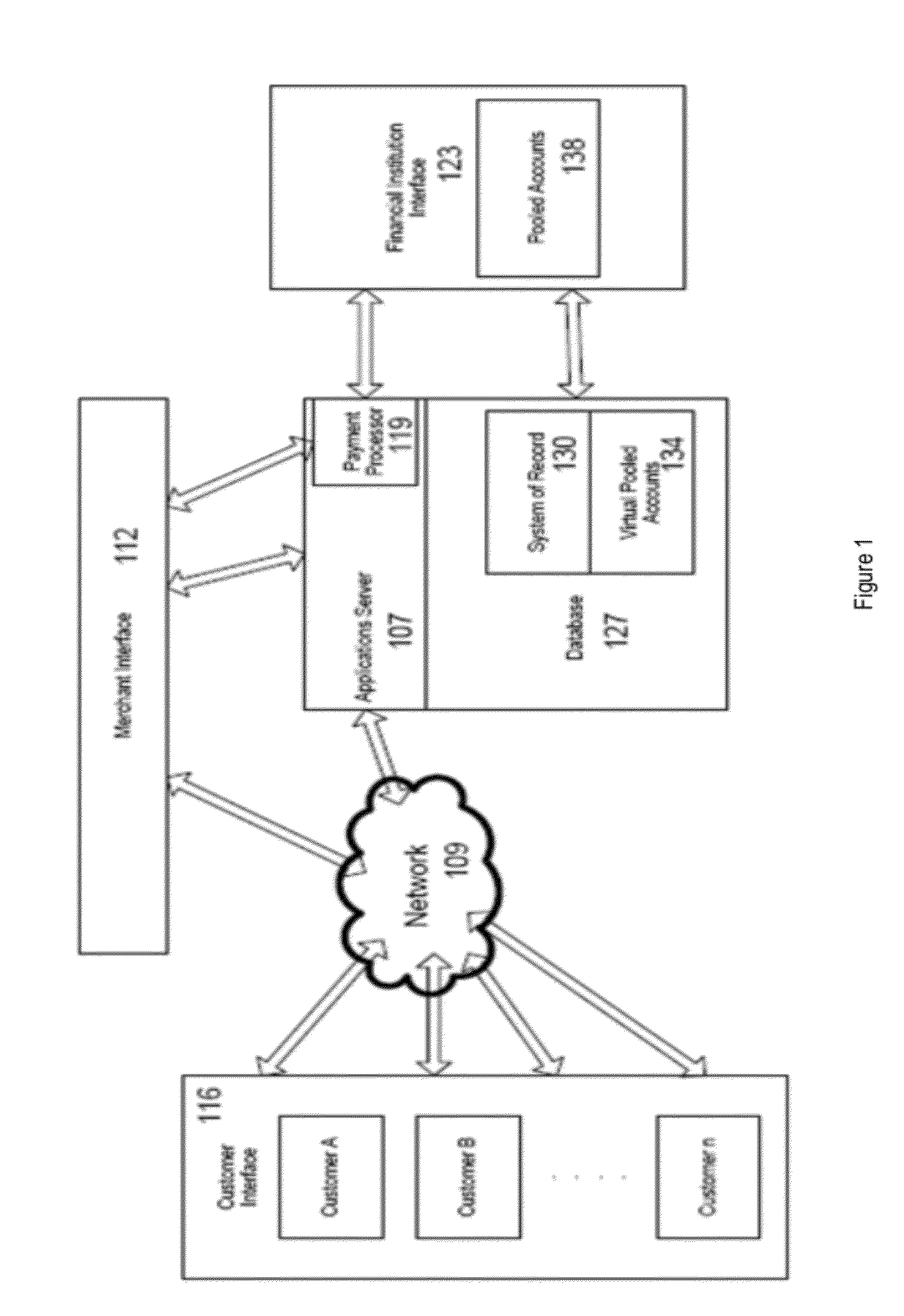

Methods and systems for facilitating transactions between commercial banks and pooled depositor groups

Owner:ANOVA FINANCIAL CORP

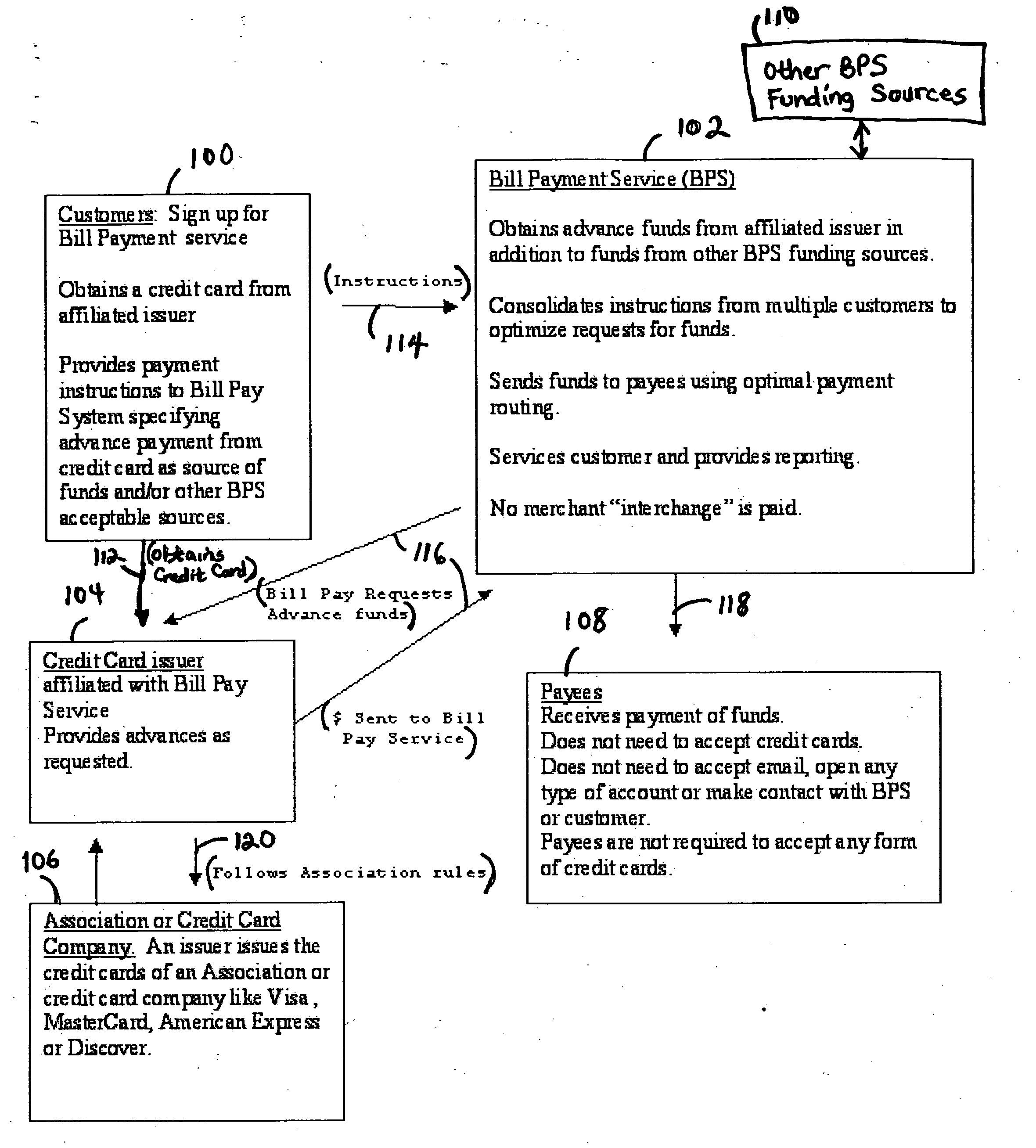

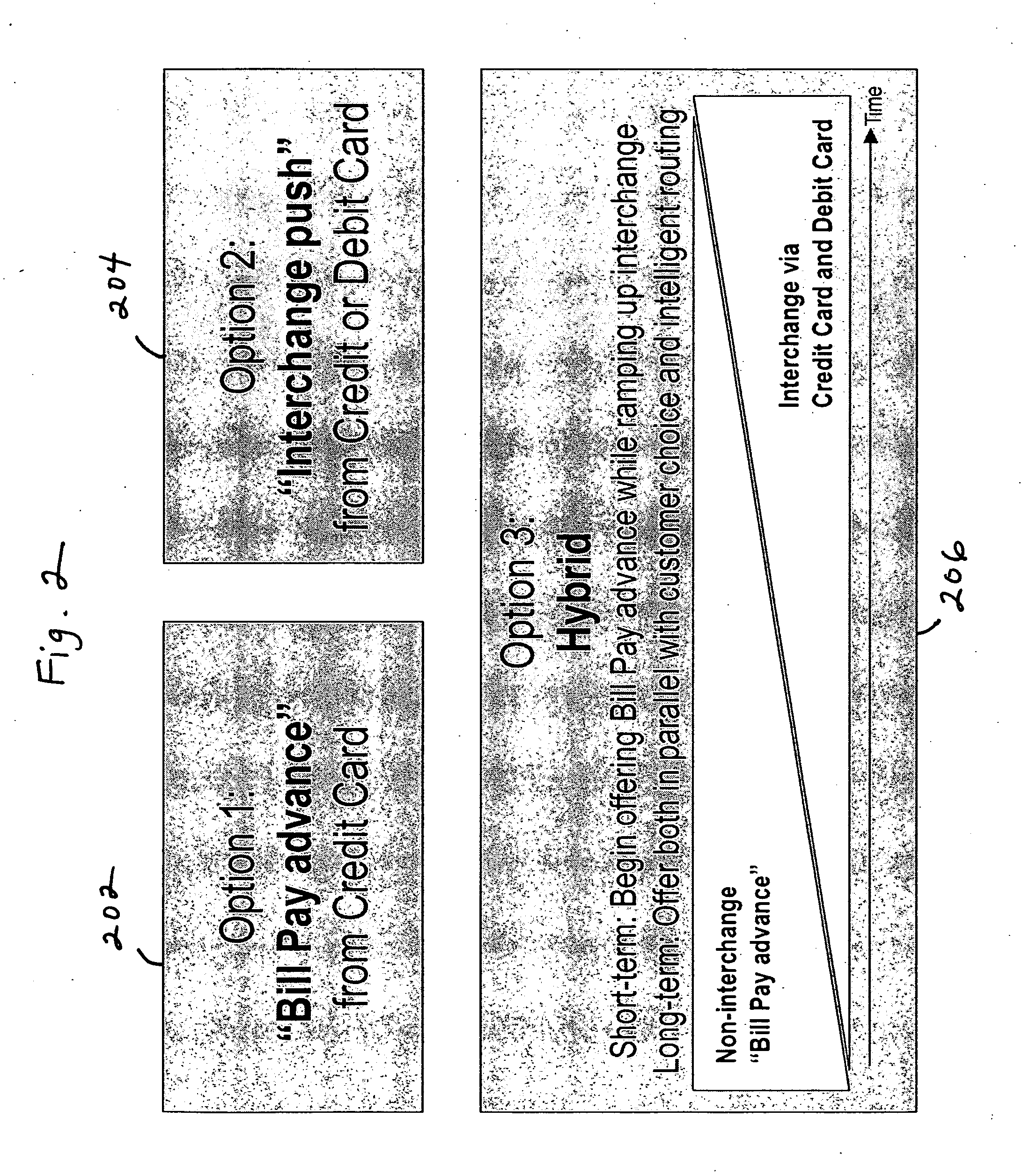

System and method for bill pay with credit card funding

An Internet based bill payment system and method is provided that allows a consumer to push payments and / or information to any payee from the consumer's credit card account. One embodiment of the invention allows the customer to make a payment to any payee from an enterprise credit card or any other credit account of the enterprise, referred to as “Bill Pay advance.” One embodiment of the invention is provided which allows an enterprise's consumer credit card customers to sign up for and use the enterprise's bill pay advance system, whether or not the consumer has a demand deposit account (DDA) account. The invention allows the customer to designate either source of funds for payment and for any payee they choose to pay. One embodiment of the invention offers an interchange push methodology with customer choice of the payment source of funds and intelligent routing.

Owner:WELLS FARGO BANK NA

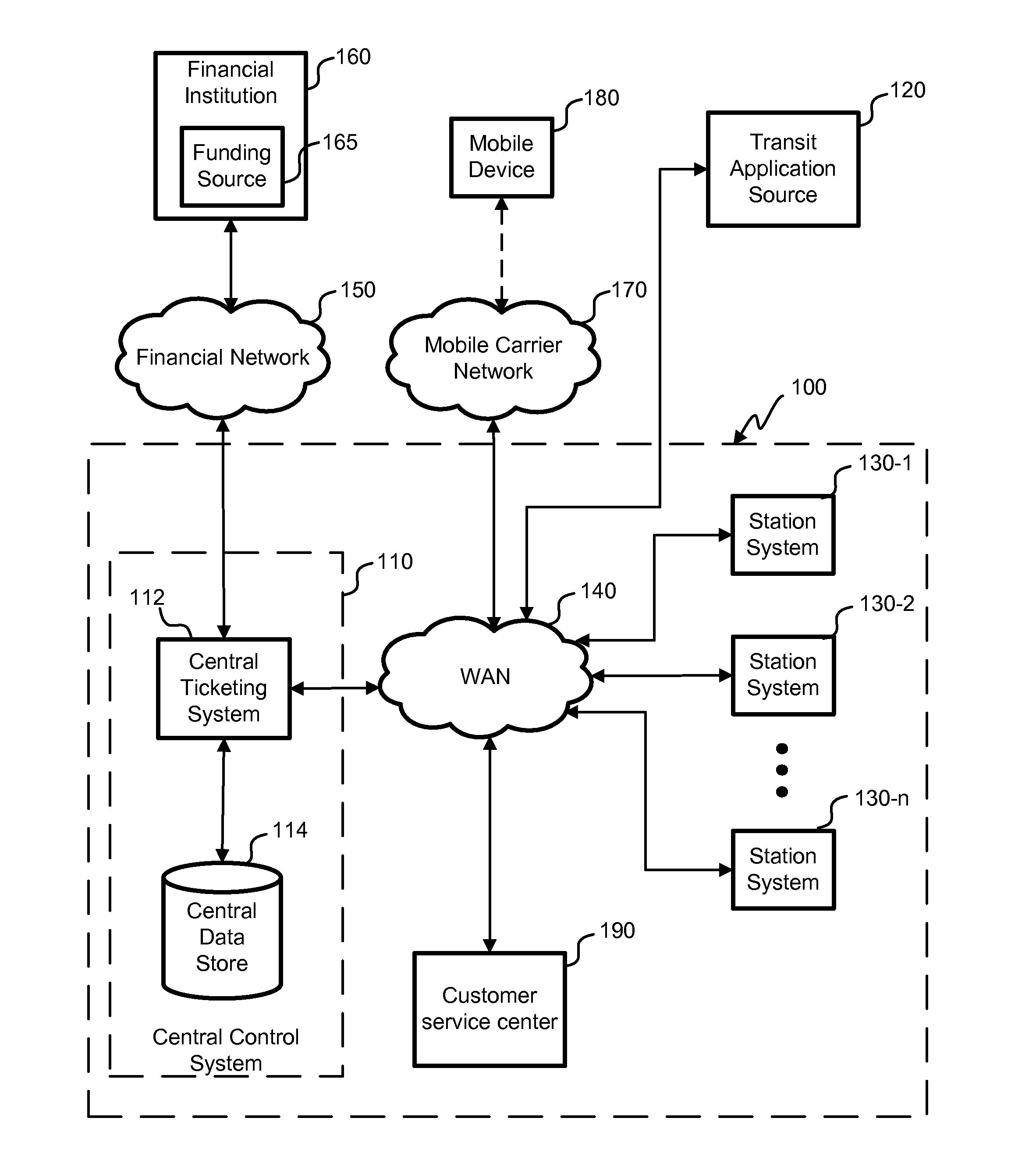

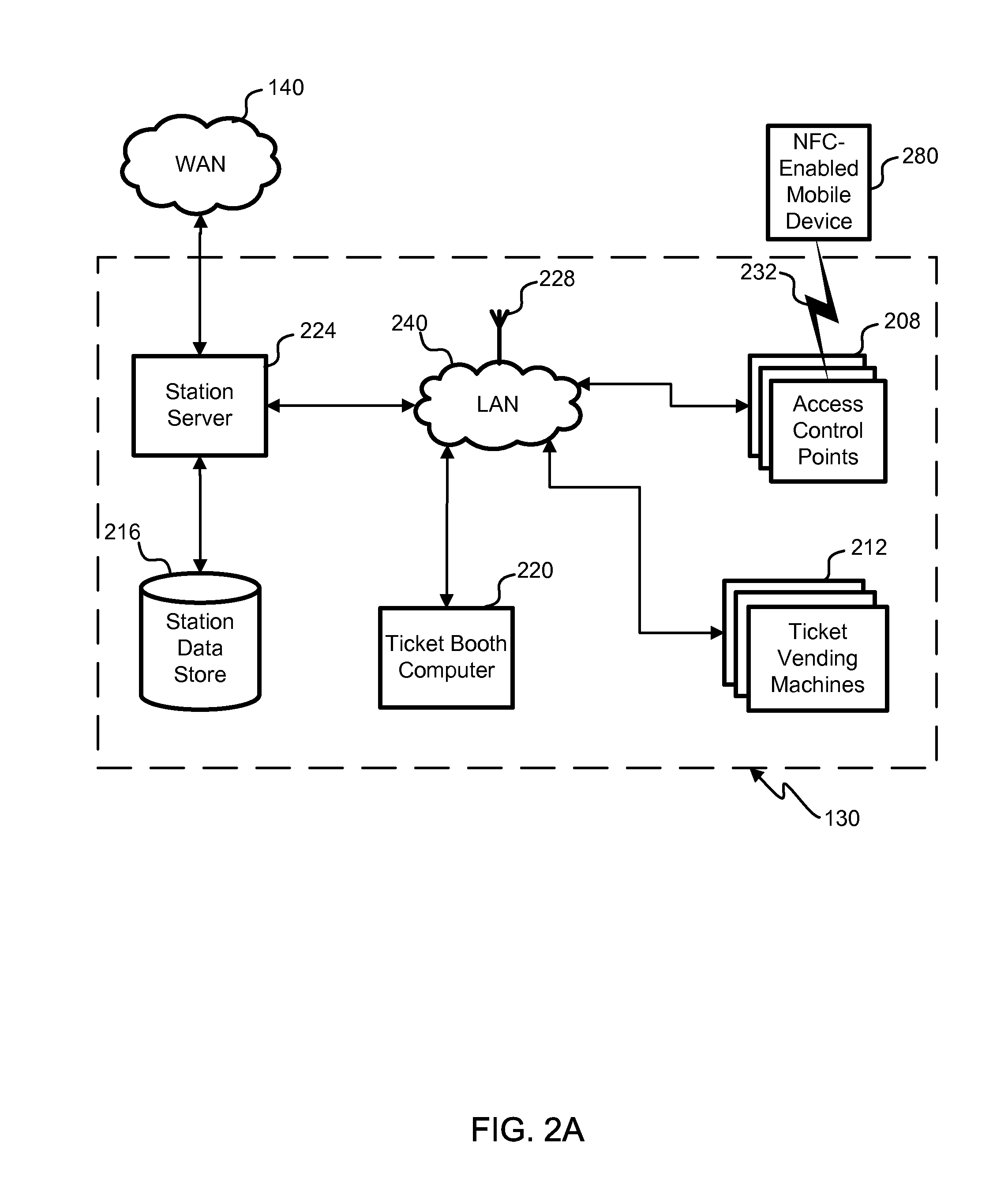

Id application for NFC phone

InactiveUS20110165836A1Risk minimizationNear-field transmissionPayment architectureTransit systemBiological activation

Embodiments of systems, methods, and machine-readable media are disclosed for enabling a mobile device having near-field communication (NFC) capabilities to be used as fare media at access control points of a transit system. Embodiments can include receiving a request for activation information from the mobile device to enable the device to transmit an identification code using NFC capabilities. Embodiments further include associating a funding source with the identification code and transmitting the activation information to the mobile device. The identification code can then be transmitted from the mobile device to an access control point, and a determination of whether to allow or deny passage of a user at the access control point can be made. The determination can be based, at least in part, on whether the identification code is included on a list. A transaction can then be associated with the identification code; and a value of the transaction can be reconciled with the funding source.

Owner:CUBIC CORPORATION

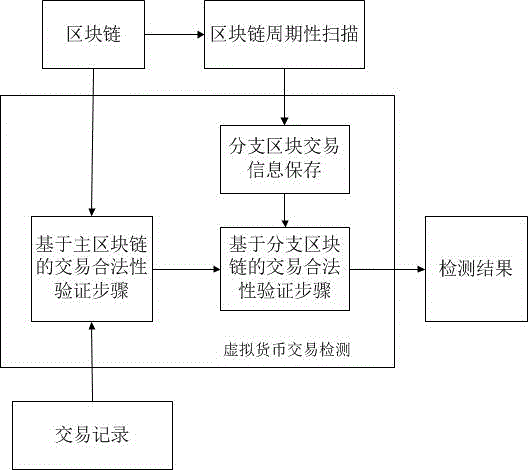

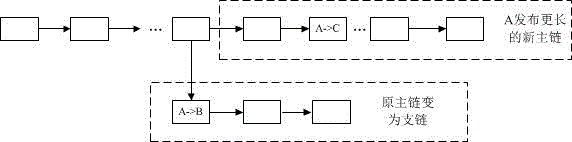

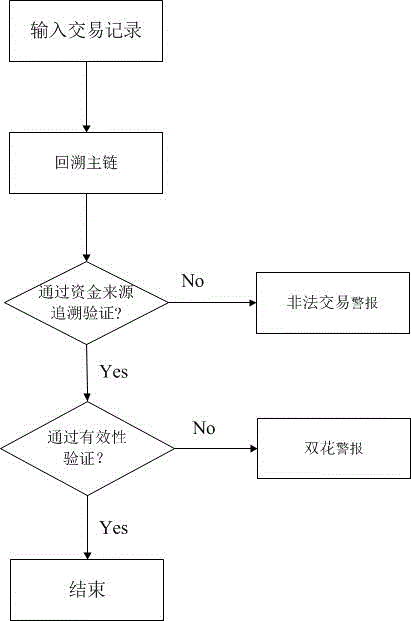

Virtual currency transaction validation method based on block chain multi-factor cross-validation

The invention provides a virtual currency transaction validation method based on block chain multi-factor cross-validation to solve the double-spending problem that virtual currency based on block chains are liable to 51% attacks and thus generates transactions. The method queries and backups a history block chain branch periodically, organizes confirmed transaction information into a hash chain list array which is easy for querying, and avoids branch transaction information losses induced by block chain evolution. During a virtual currency transaction, the method not only checks payer information, recipient information, a fund source, a currency transaction amount and the like recorded in a current main block chain, but also queries a backup branch block chain to check whether the current transaction and a history transaction on the branch block chain have the same fund source. If any transaction does not pass the check, a miner gives an alarm over the whole network about the transaction, so that the method can avoid the double-spending problem induced by illegal transactions.

Owner:SICHUAN UNIV

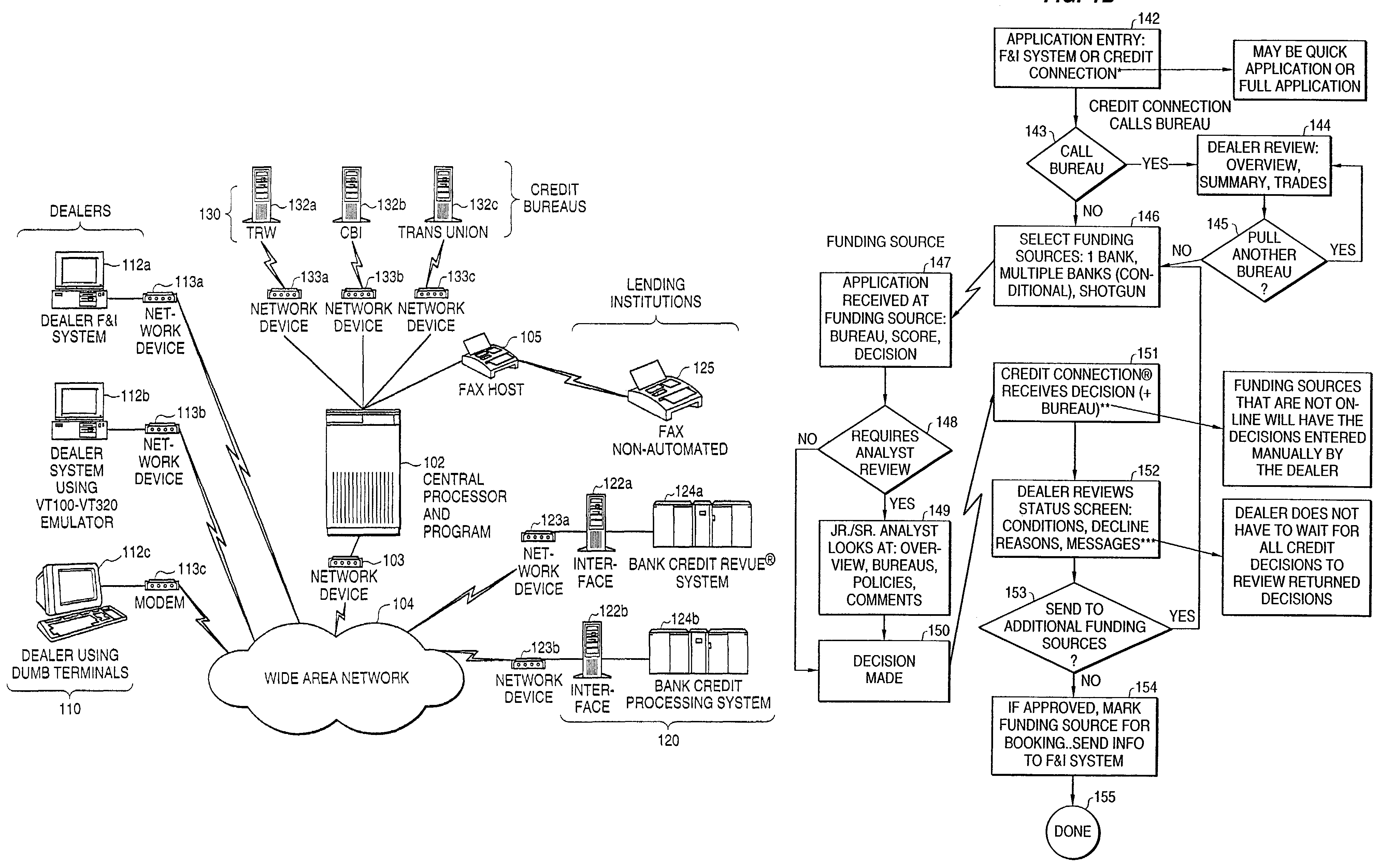

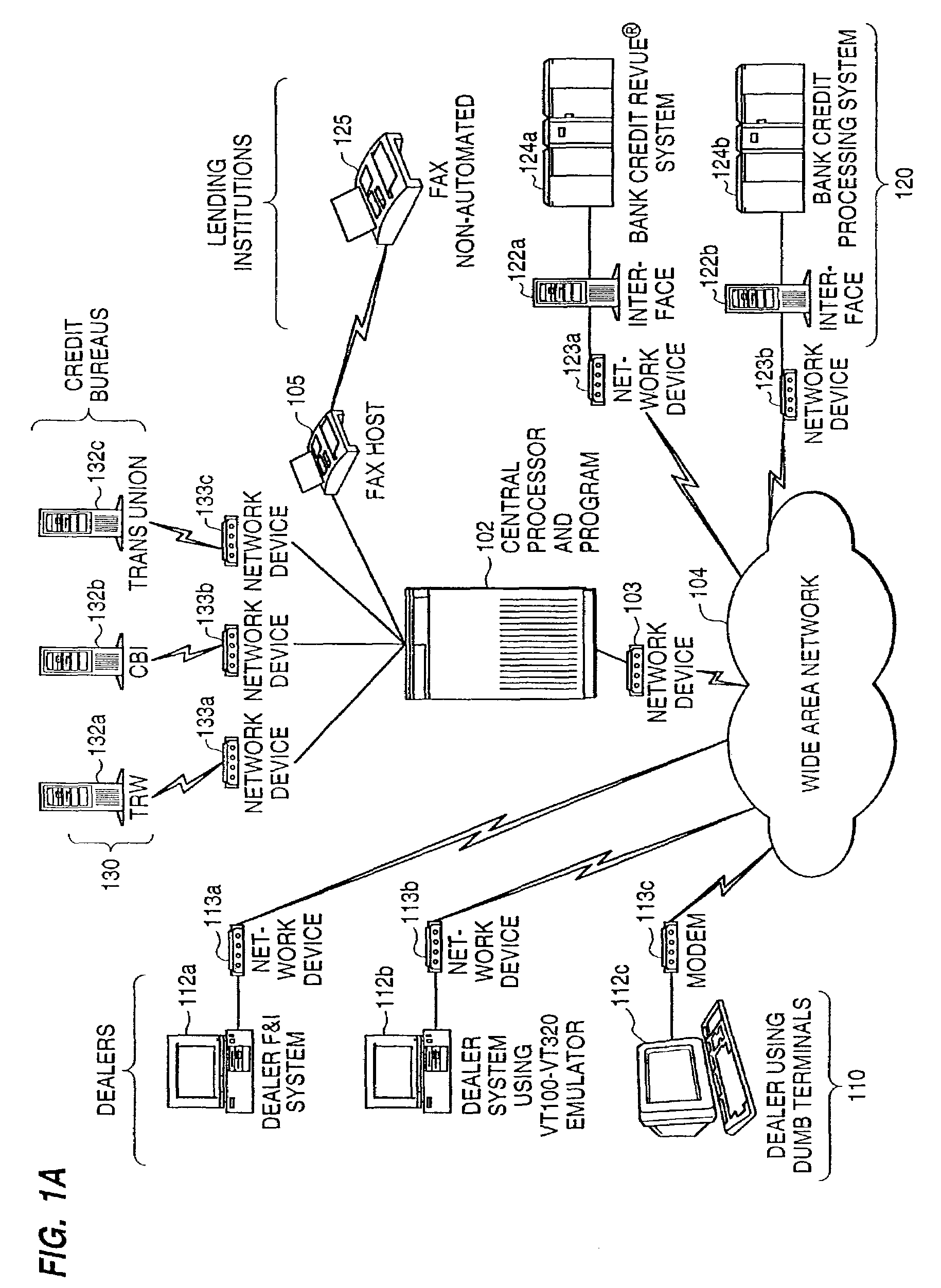

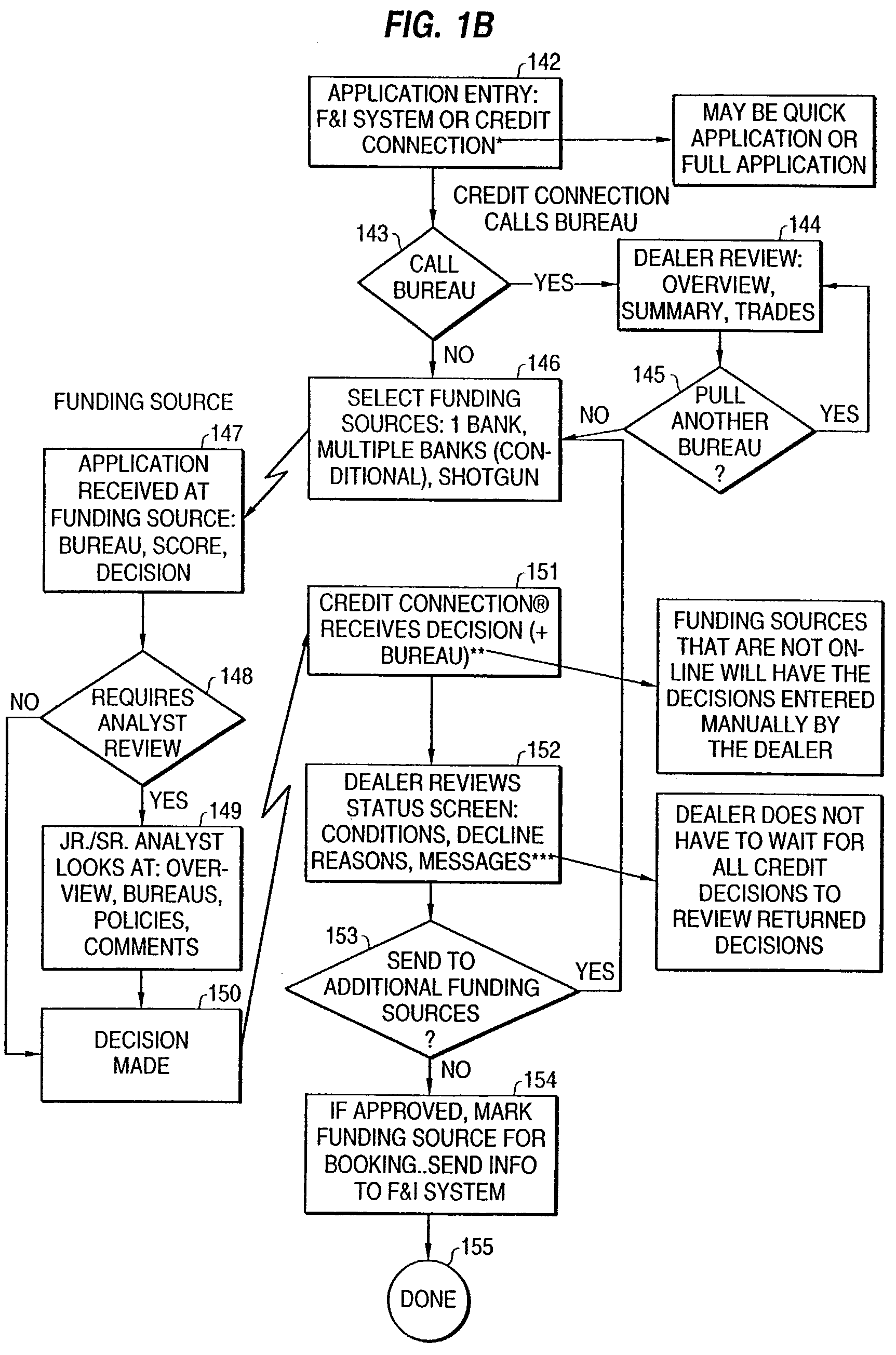

Computer implemented automated credit application analysis and decision routing system

InactiveUS7801807B2Eliminate errorsEliminating the entry of credit applicationsFinanceMultiple digital computer combinationsDisplay deviceApplication software

A credit application and routing system includes a central processor having and executing a program. The system includes data input capabilities for selectively receiving credit application data from respective applicants at remote locations, and routing capabilities for selectively forwarding the credit application data to remote funding sources and selectively forwarding funding decision data from the funding sources to the respective applicants. The computer program includes routines for receiving a credit application from at least one remote application input and display device, for selectively forwarding a received credit application to at least one finding source, for receiving a finding decision from the at least one finding source, and for forwarding a received funding decision to the at least one remote application input and display device. The system can also obtain credit report data from credit bureaus, and analyze and summarize the credit report data. A computer readable storage medium has a substrate physically configured to represent the computer program which causes a computer to provide the credit application and routing system.

Owner:FIRST AMERICAN CMSI +1

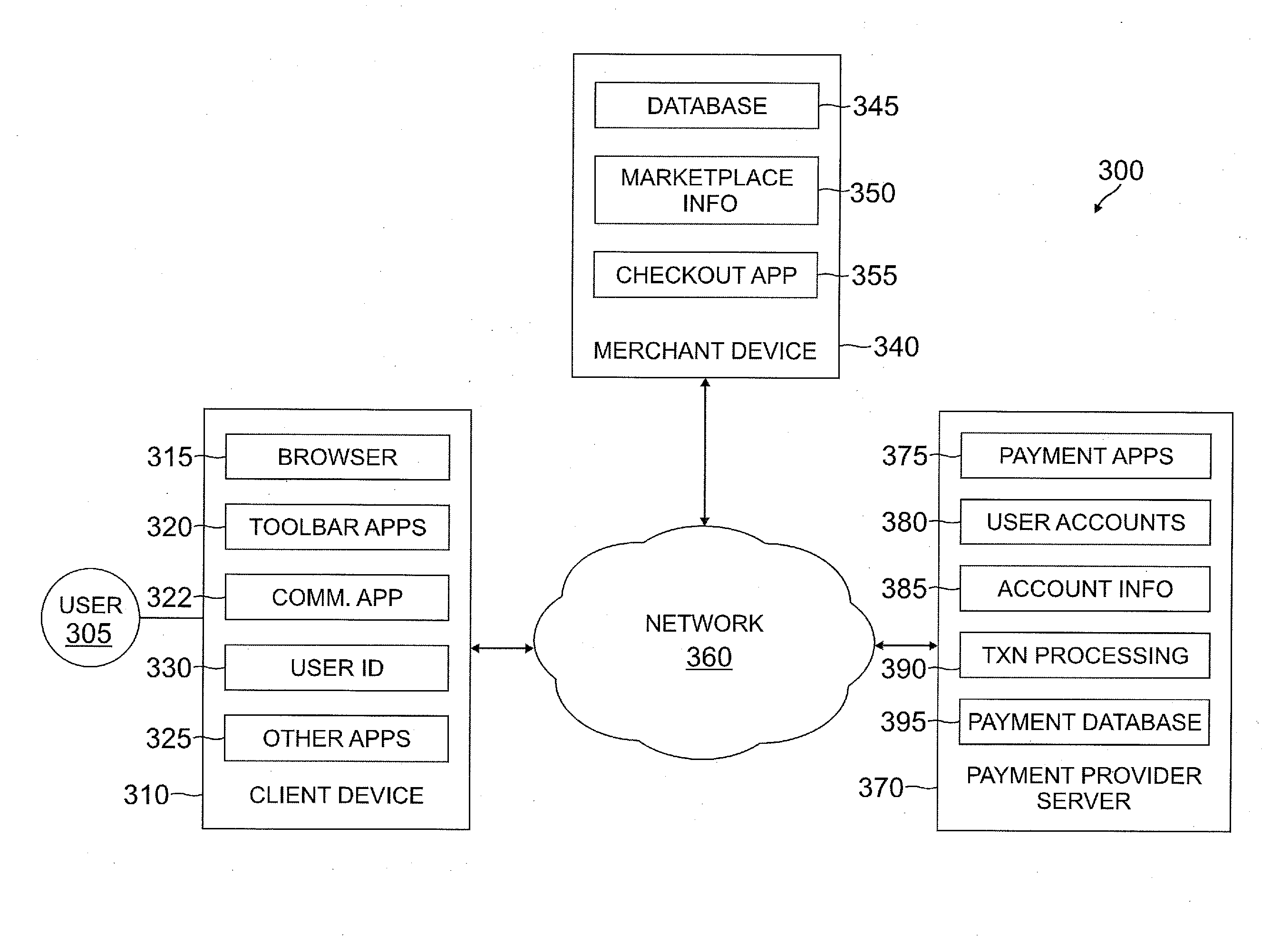

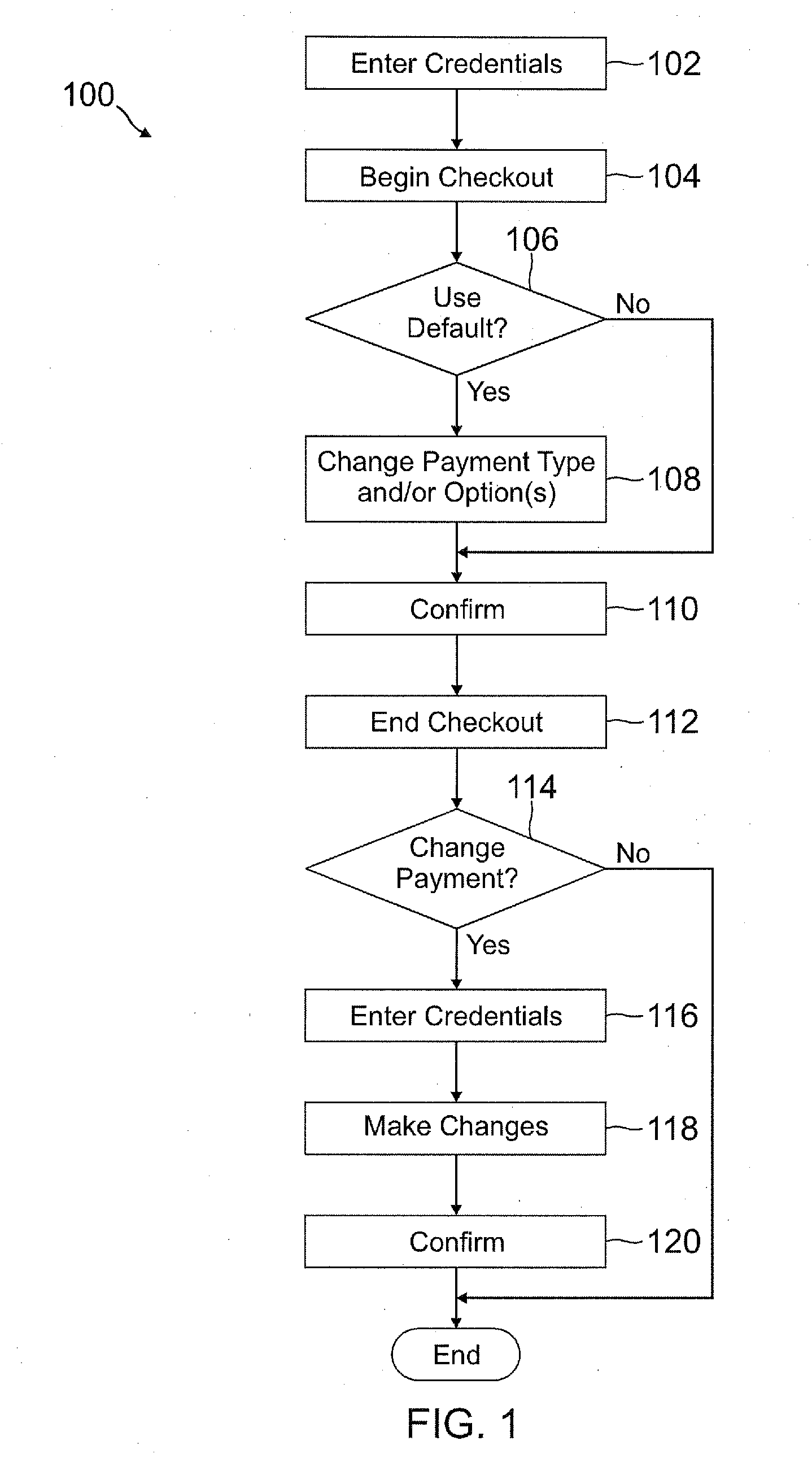

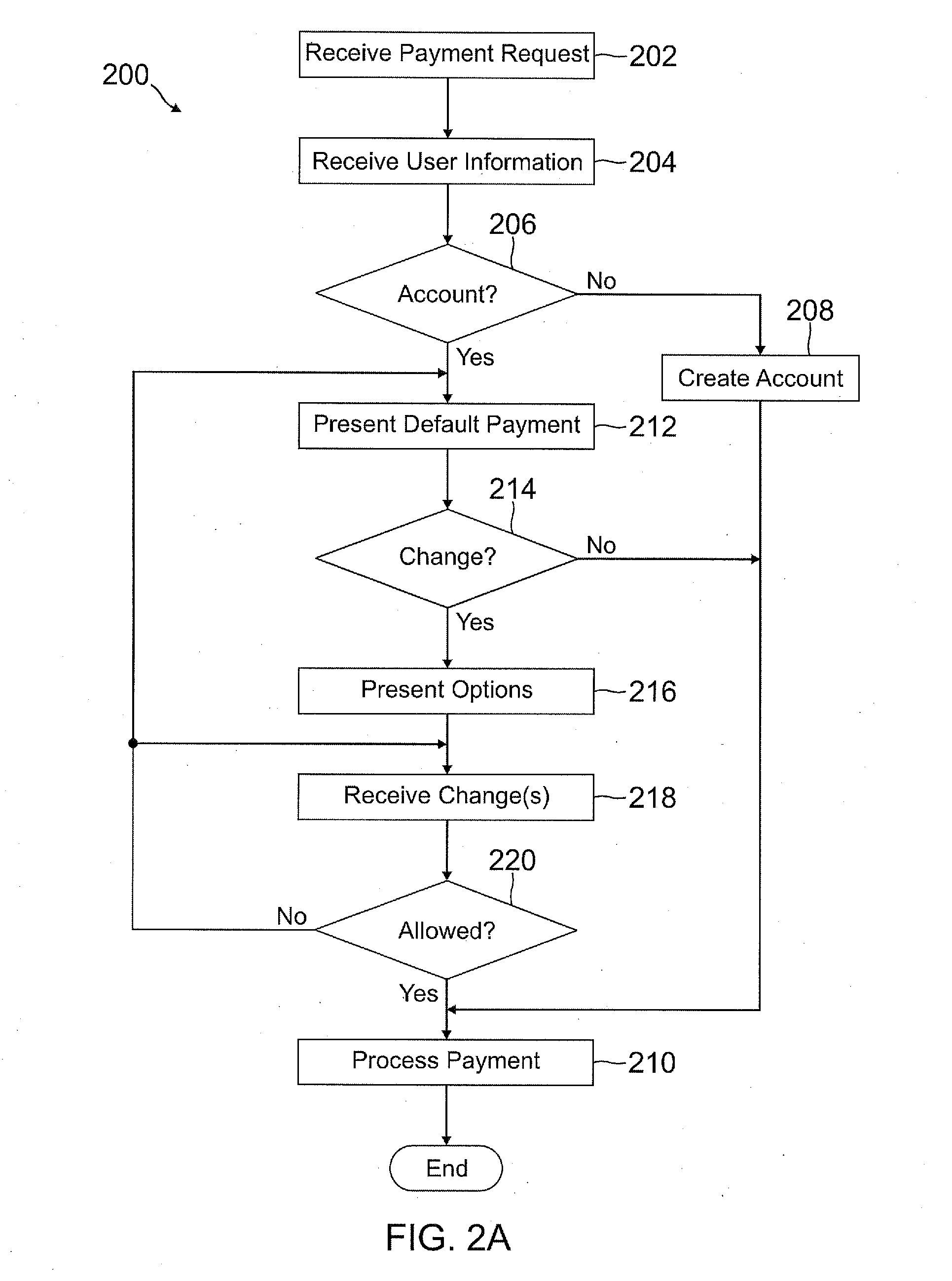

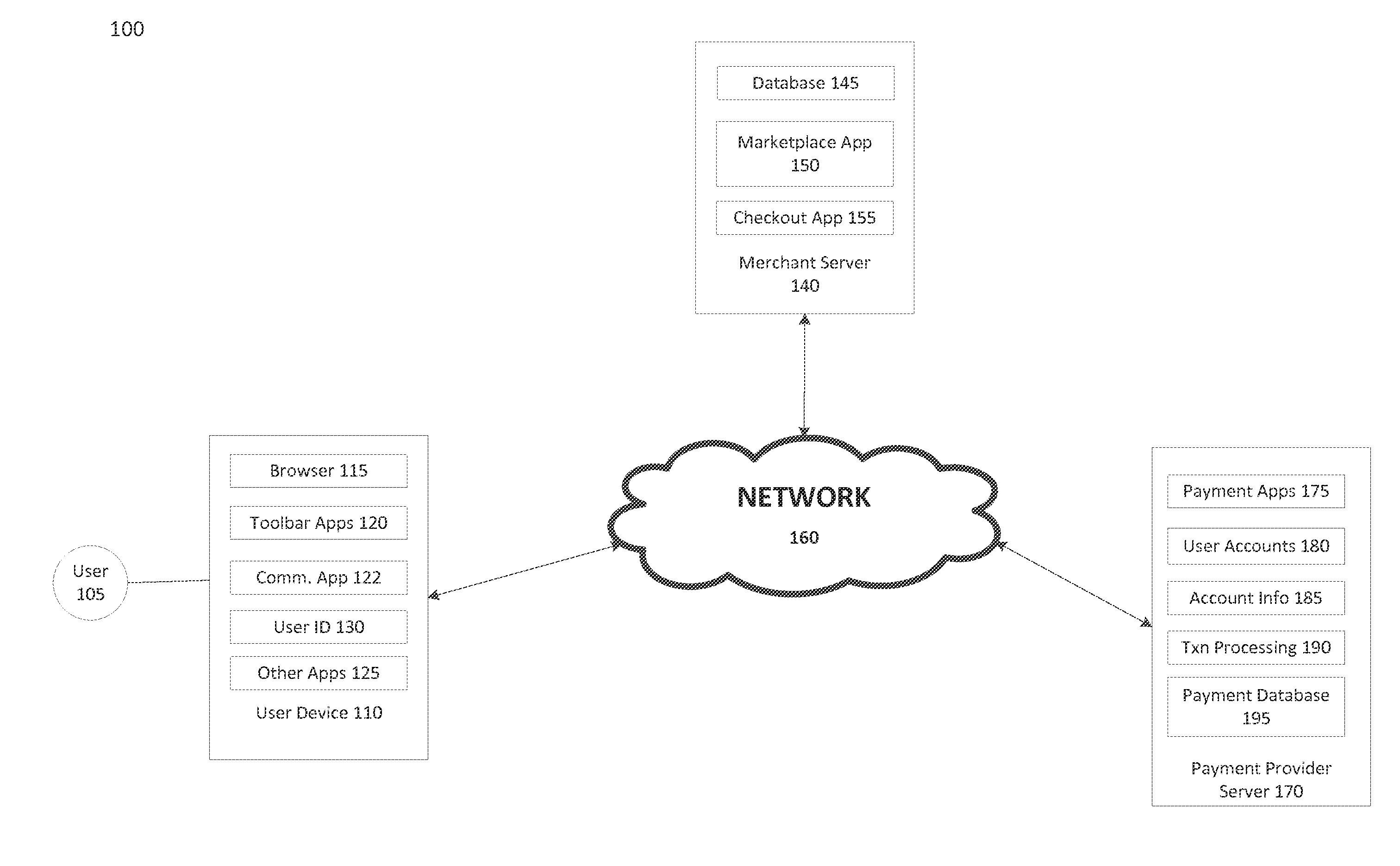

Deferred payment and selective funding and payments

InactiveUS20120166311A1Increase flexibilityEasy to controlPayment architectureBuying/selling/leasing transactionsPaymentEmail address

A user is able to change one or more payment options after payment has already been made to a merchant. A payment provider processes a payment request during a transaction with the merchant with default or selected payment options. After the transaction with the merchant is completed and the merchant has been paid, the user may change one or more of the payment options, such as funding source(s) and terms / conditions of payment (e.g., deferment period, installment period / amount, etc.). During the transaction, the user may make a purchase through the payment provider even if the user does not have an account with the payment provider by providing user information, such as name, address, phone number, email address, and date of birth, but not a social security number or funding source information.

Owner:PAYPAL INC

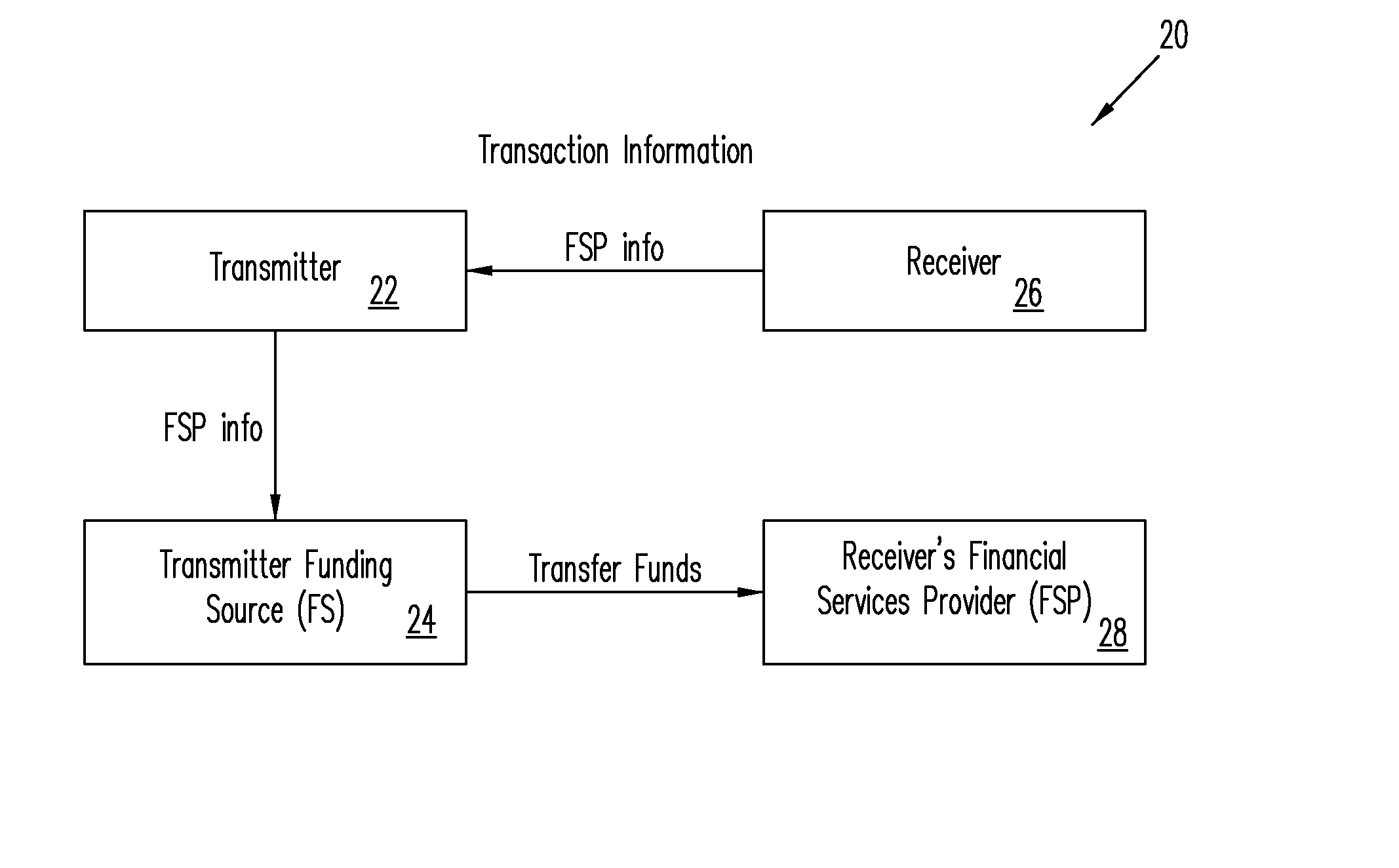

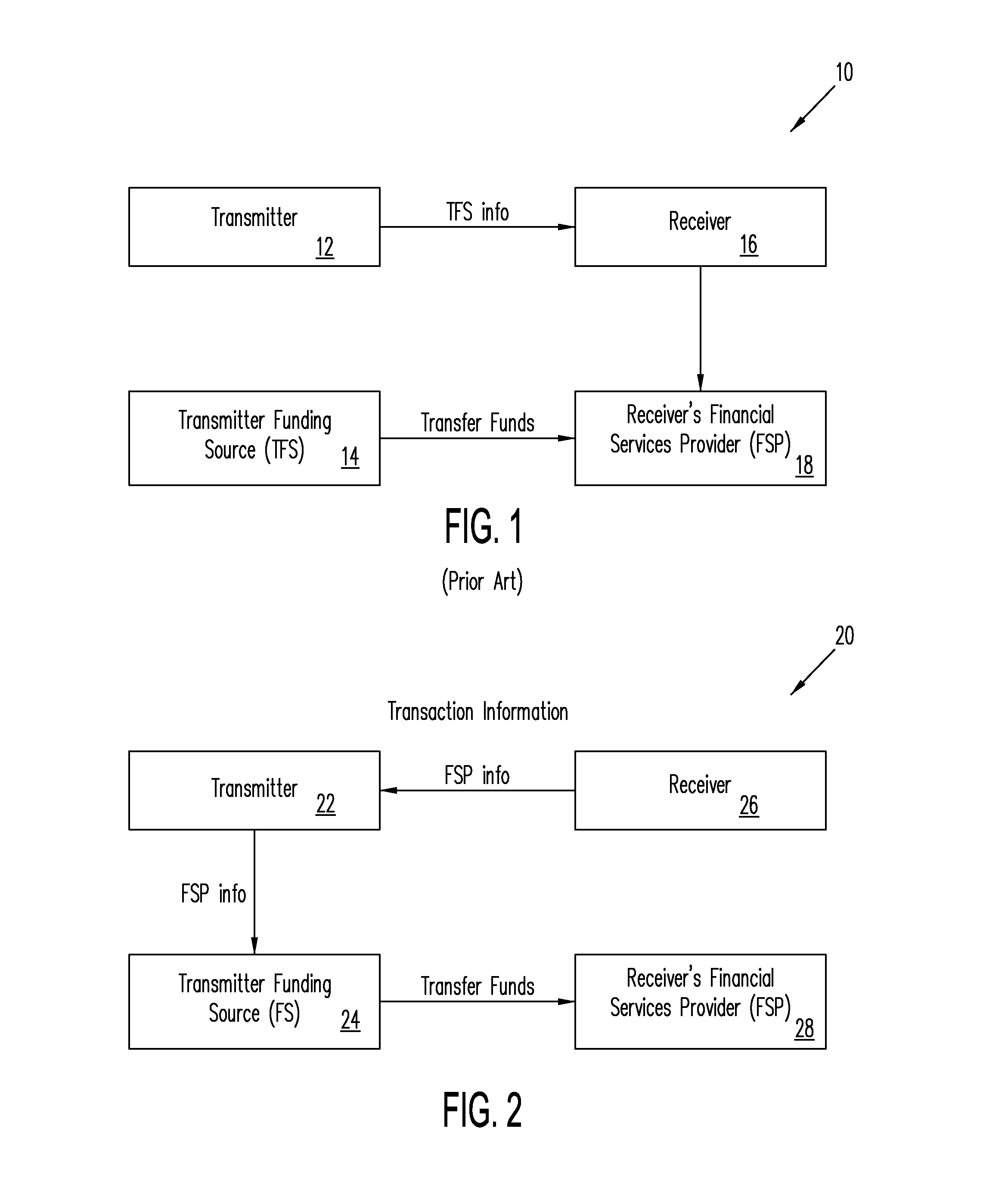

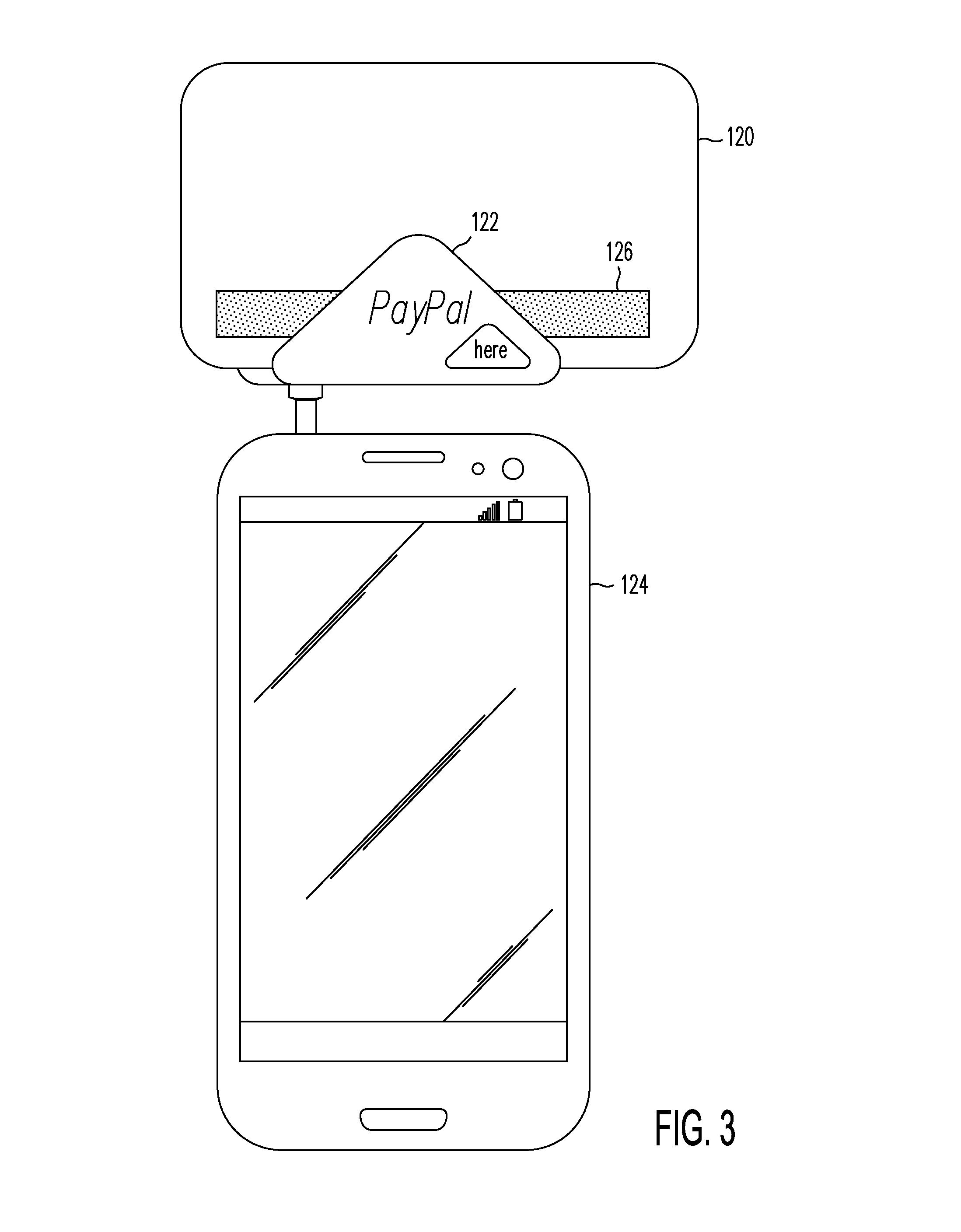

Systems, Methods, And Computer Program Products Providing Push Payments

In electronic financial transactions a receiver, or targeted recipient of funds, provides account information to a transmitter, or sender of funds. The transmitter initiates a push of funds from a transmitter funding source to the receiver's funding source processor. In some embodiments the receiver provides a payment card, similar to a credit card, which is read by an electronic device of the transmitter, such as a smart phone. In some embodiments, the receiver provides the account information by way of a bar code, such as a QR code, which is scanned and read by the transmitter's electronic device.

Owner:PAYPAL INC

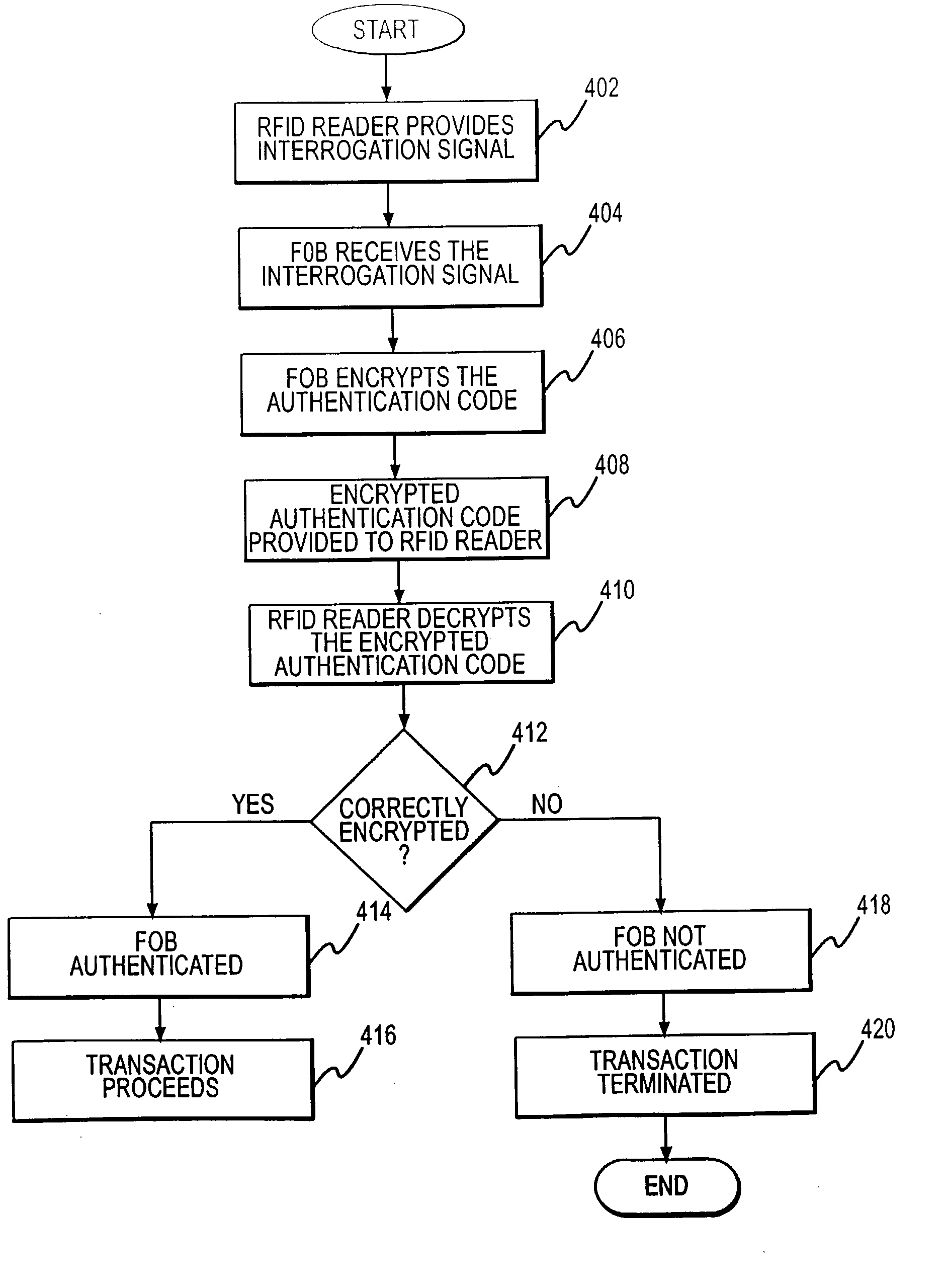

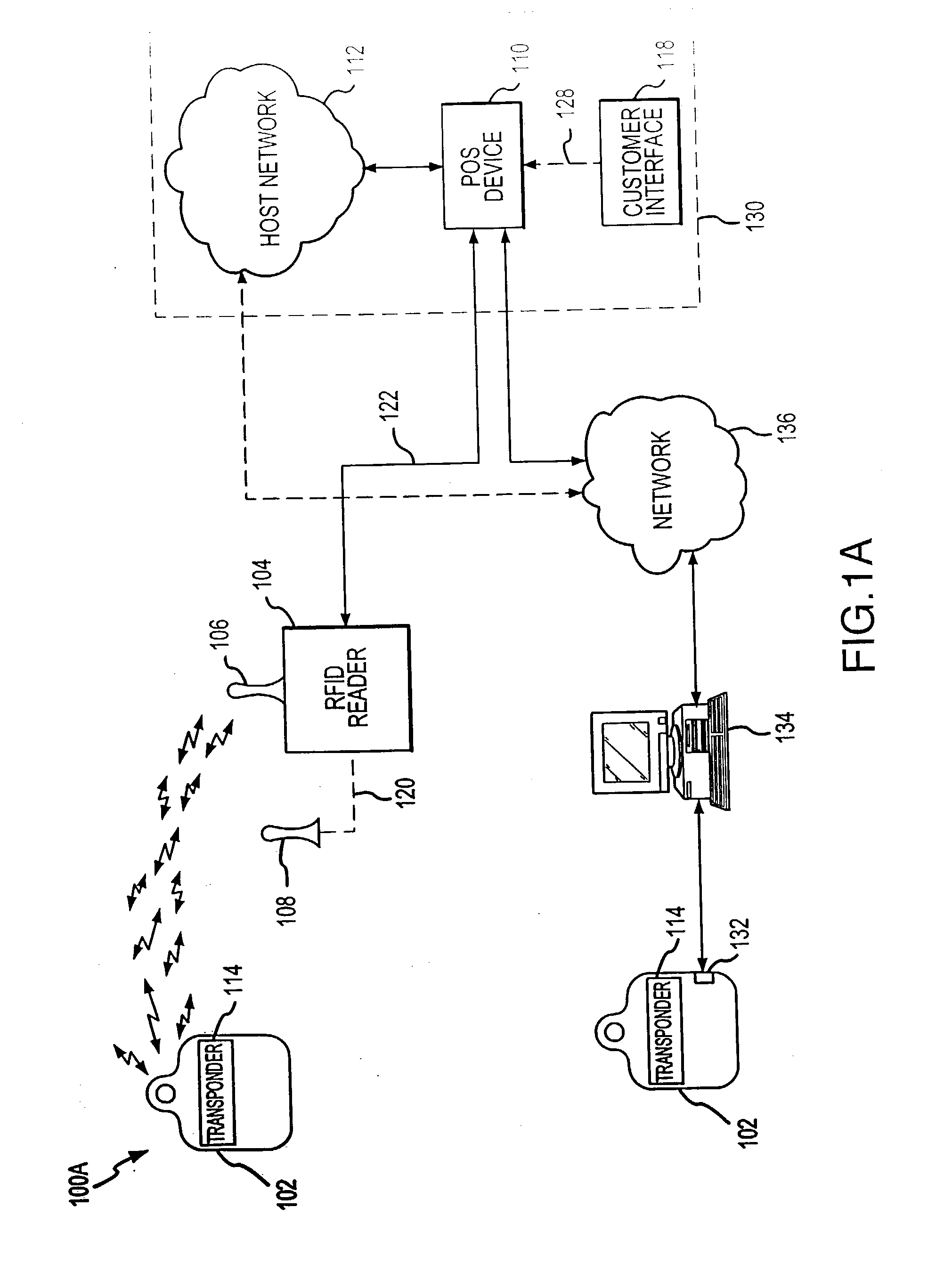

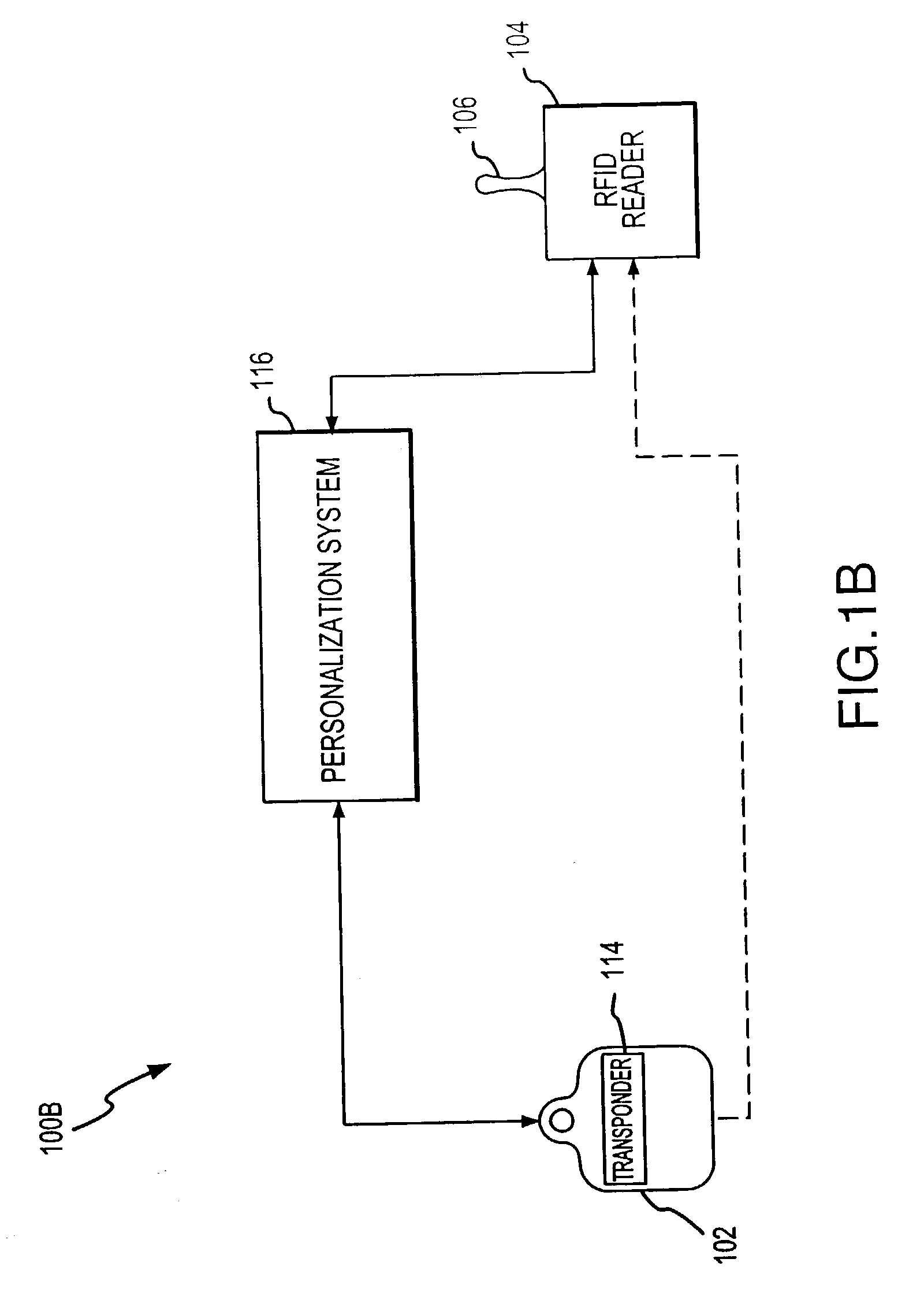

System and method for payment using radio frequency identification in contact and contactless transactions

InactiveUS20050165695A1Easy to completeEasy to trackVisual presentationIndividual entry/exit registersPaymentProtocol processing

A transponder-reader payment system includes a RFID reader for interrogating a transponder, and a fob including a transponder which is associated with fob data file funded by one or more funding sources. In exemplary operation, the fob identifying information may be presented to the RFID reader for completion of a transaction request. The transaction request may be provided to a fob issuer system which may process the transaction request in accordance with a funding protocol wherein the transaction request is satisfied according to a fob issuer predefined funding criteria relative to the multiple funding sources.

Owner:LIBERTY PEAK VENTURES LLC

Methods and Systems for Facilitating Transactions Between Commercial Banks and Pooled Depositor Groups

Owner:ANOVA FINANCIAL CORP

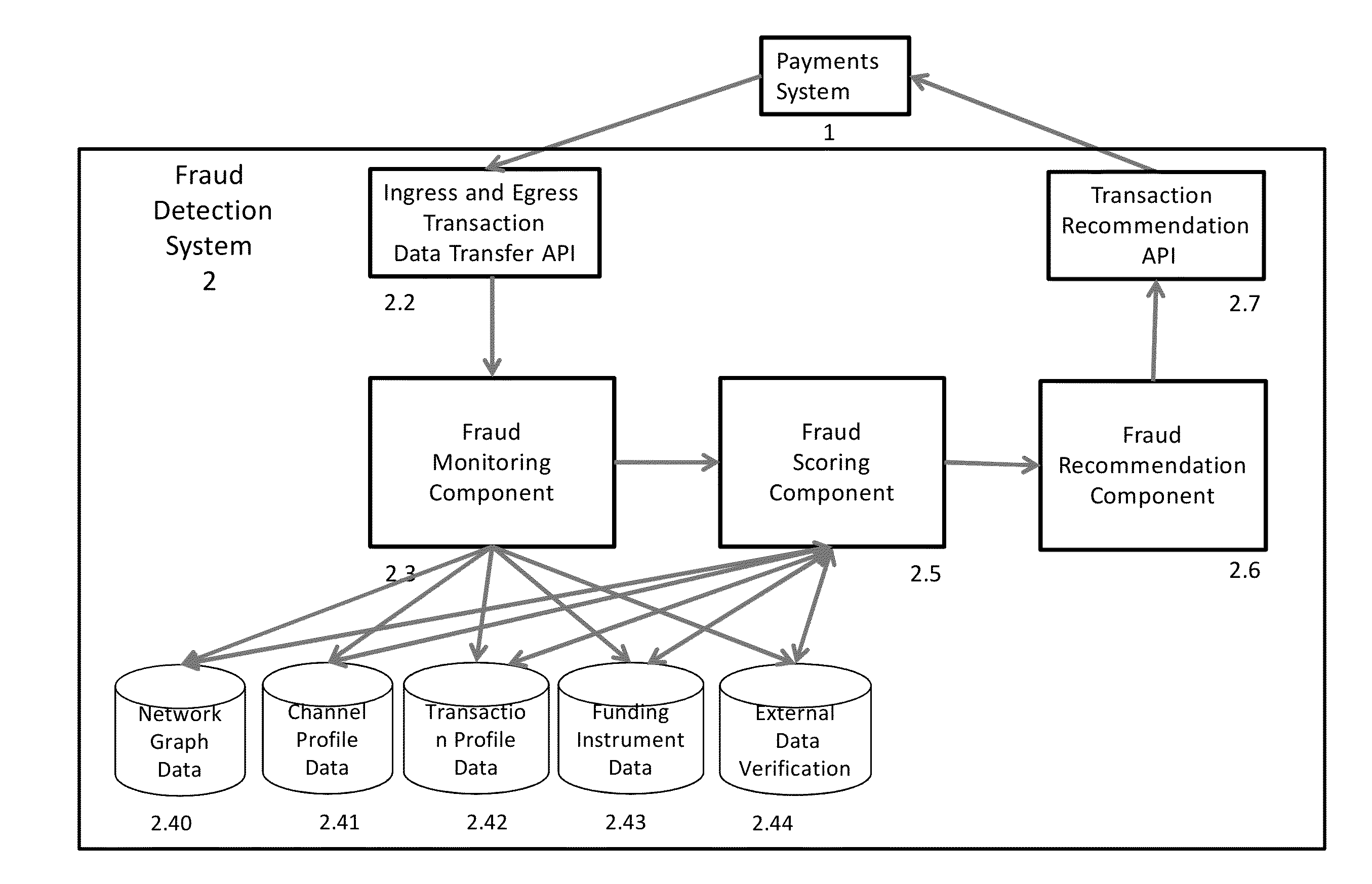

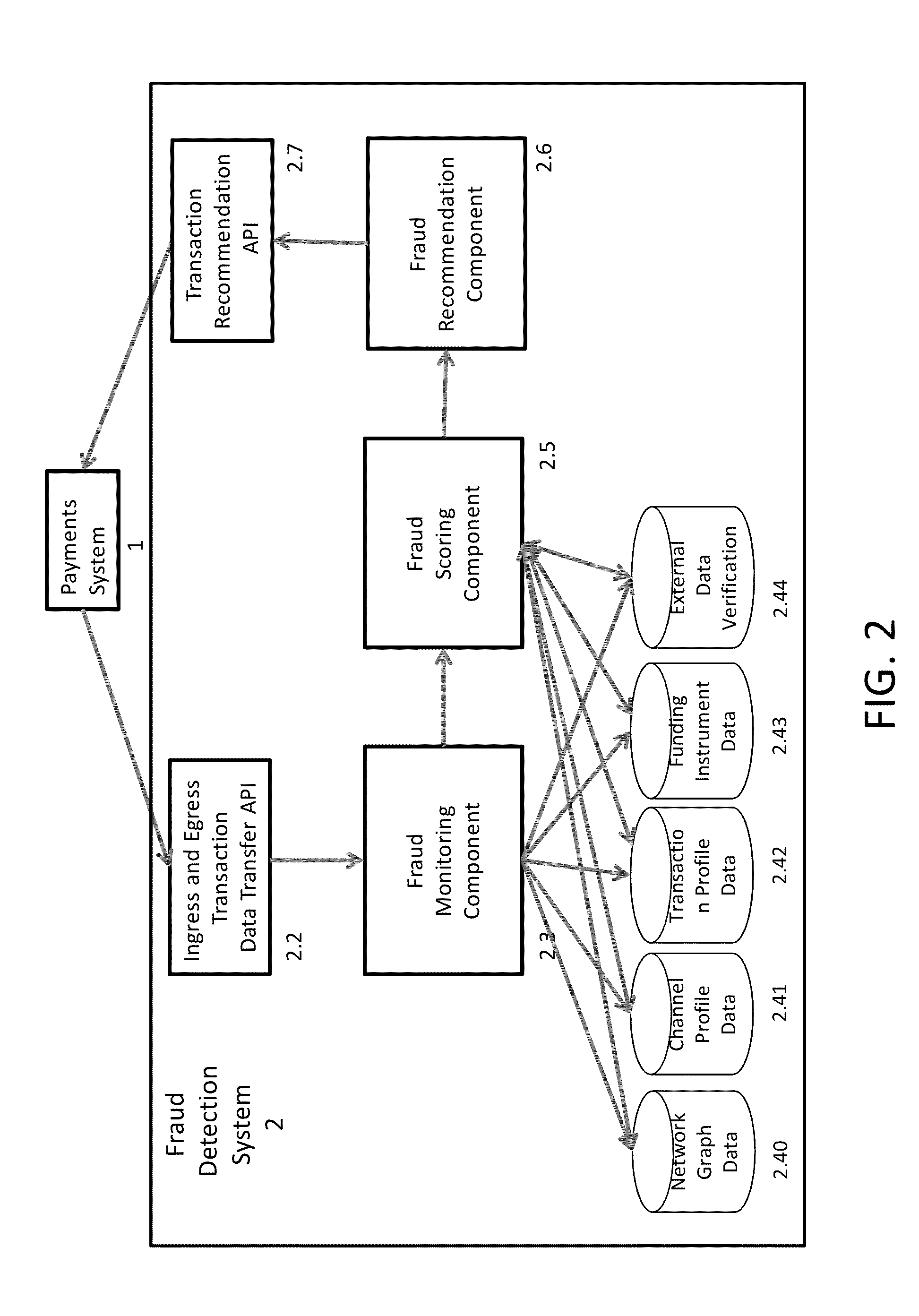

Multi-Channel Data Driven, Real-Time Fraud Determination System For Electronic Payment Cards

ActiveUS20130018795A1Easy to detectFinanceProtocol authorisationPaymentApplication programming interface

Exemplary embodiments for detecting electronic payment card fraud include receiving real-time payment card transaction data from ingress channels and an egress channels of at least one payment card system through a first application programming interface (API); generating transactional profiles for each of at least payment cards, the ingress channel, the egress channels, and funding sources of the payment cards; in response to receiving transaction data for a current payment card transaction, evaluating the transaction data using a predictive algorithm that compare the transaction data to the transactional profiles to calculate a probabilistic fraud score for the current transaction; evaluating the probabilistic fraud score and the current transaction data based on a set of rules to generate a recommendation to approve, decline or review the current transaction; and transmitting the recommendation back to the payment card system via a second API.

Owner:WALMART APOLLO LLC

Systems and methods to process donations

ActiveUS20120276868A1Facilitate donationAccounting/billing servicesFundraising managementPaymentCommunication control

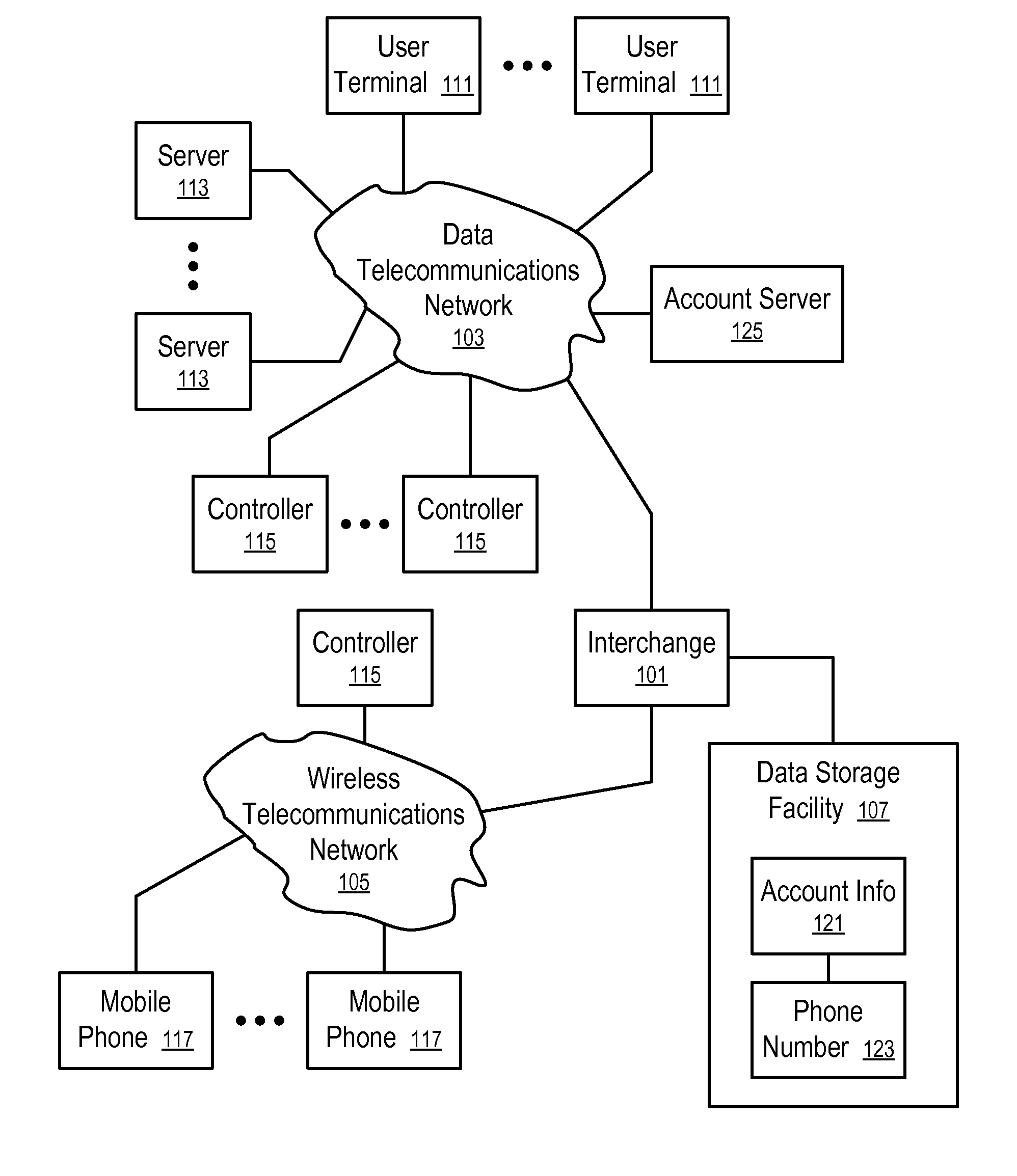

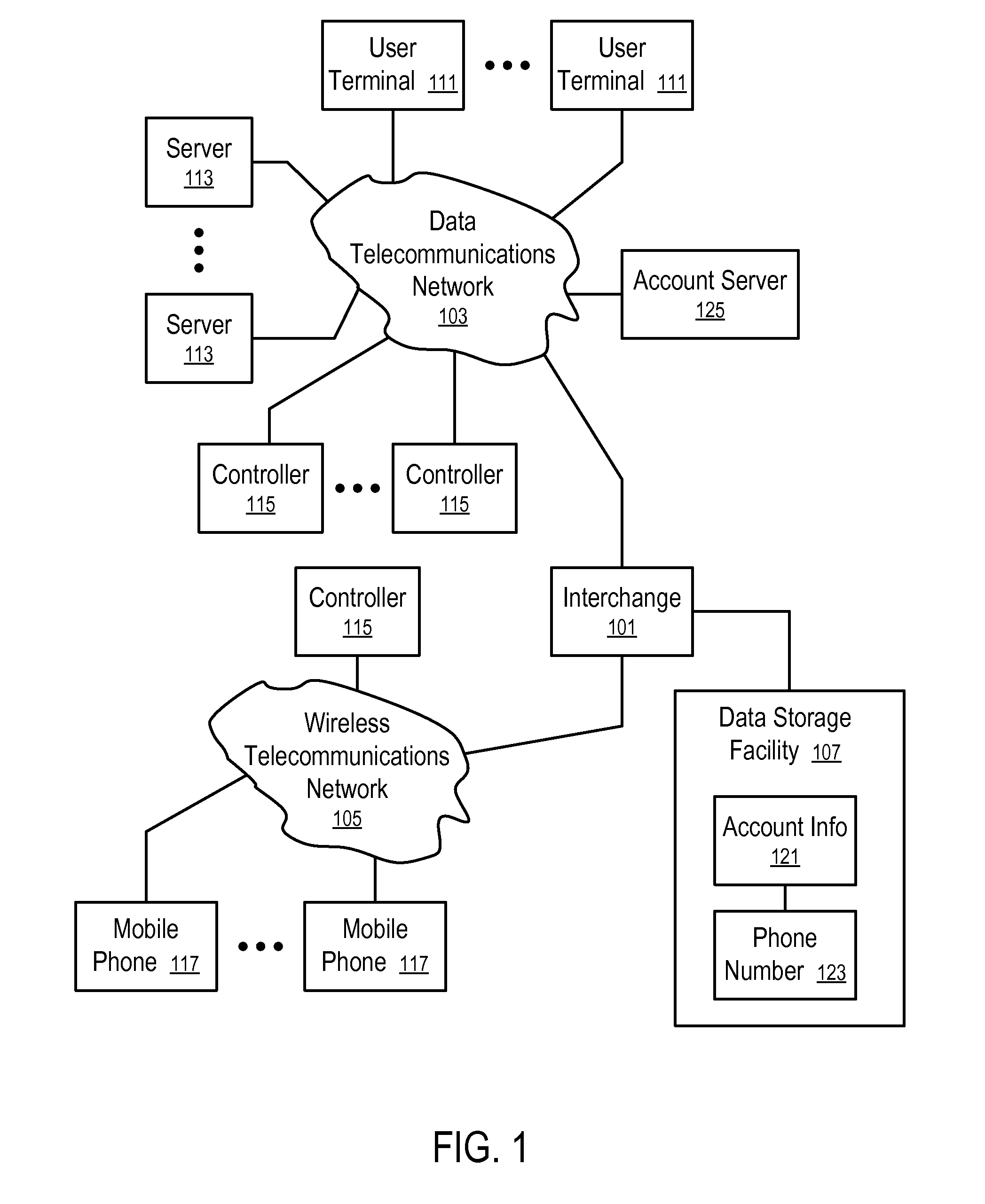

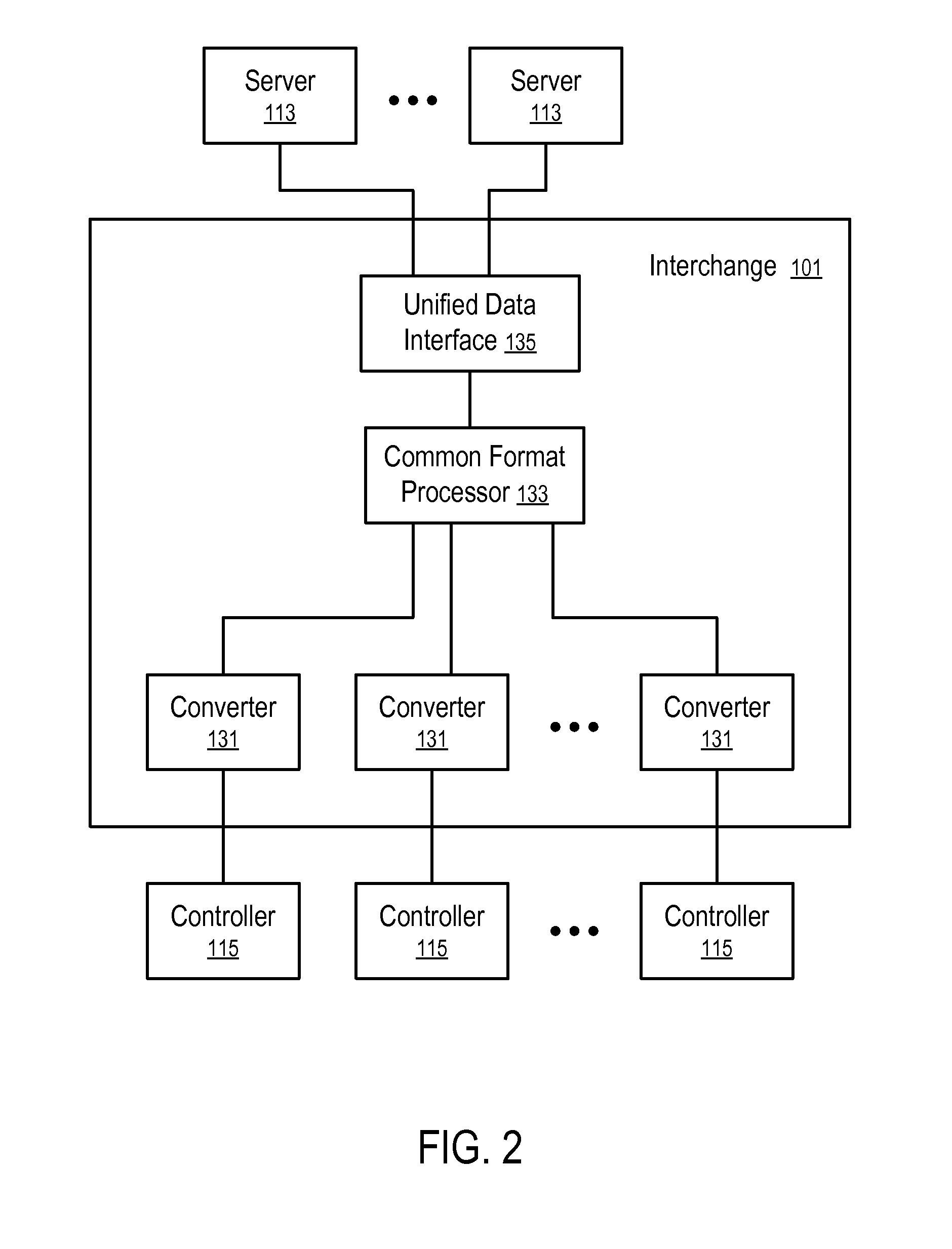

Systems and methods are provided to facilitate donations via mobile communications. In one aspect, a system includes a data storage facility and an interchange having a common format processor and a plurality of converters to interface with a plurality of different controllers of mobile communications. The converters are configured to communicate with the controllers in different formats and with the common format processor in a common format. For a payment to a merchant, the common format processor provides a user interface configured to present charity donation options in response to a phone number being specified in the user interface to identify a fund source. The common format processor uses one of the converters to communicate with a mobile phone at the phone number to confirm the payment to the merchant and a donation to a separate charity organization specified via the user interface.

Owner:BOKU

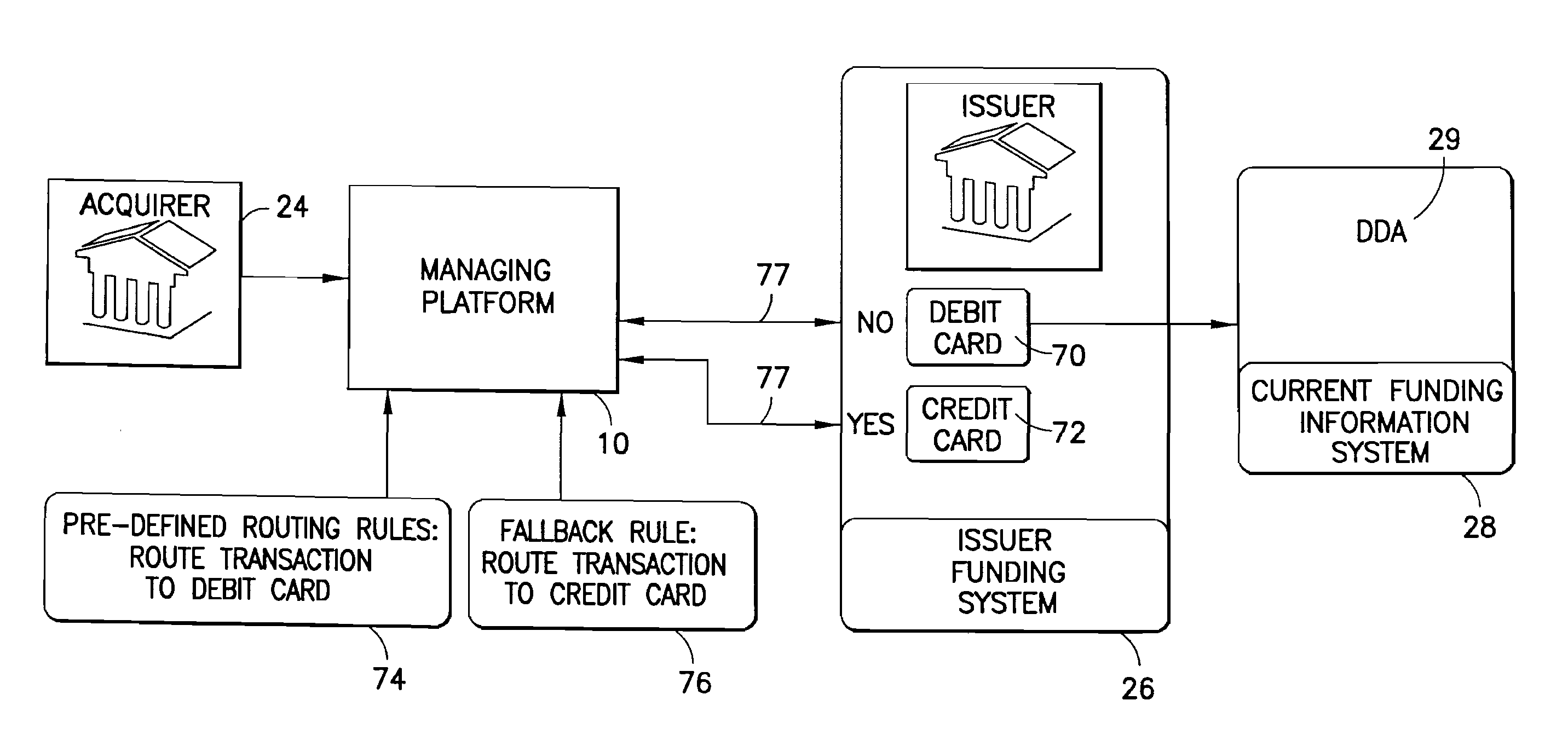

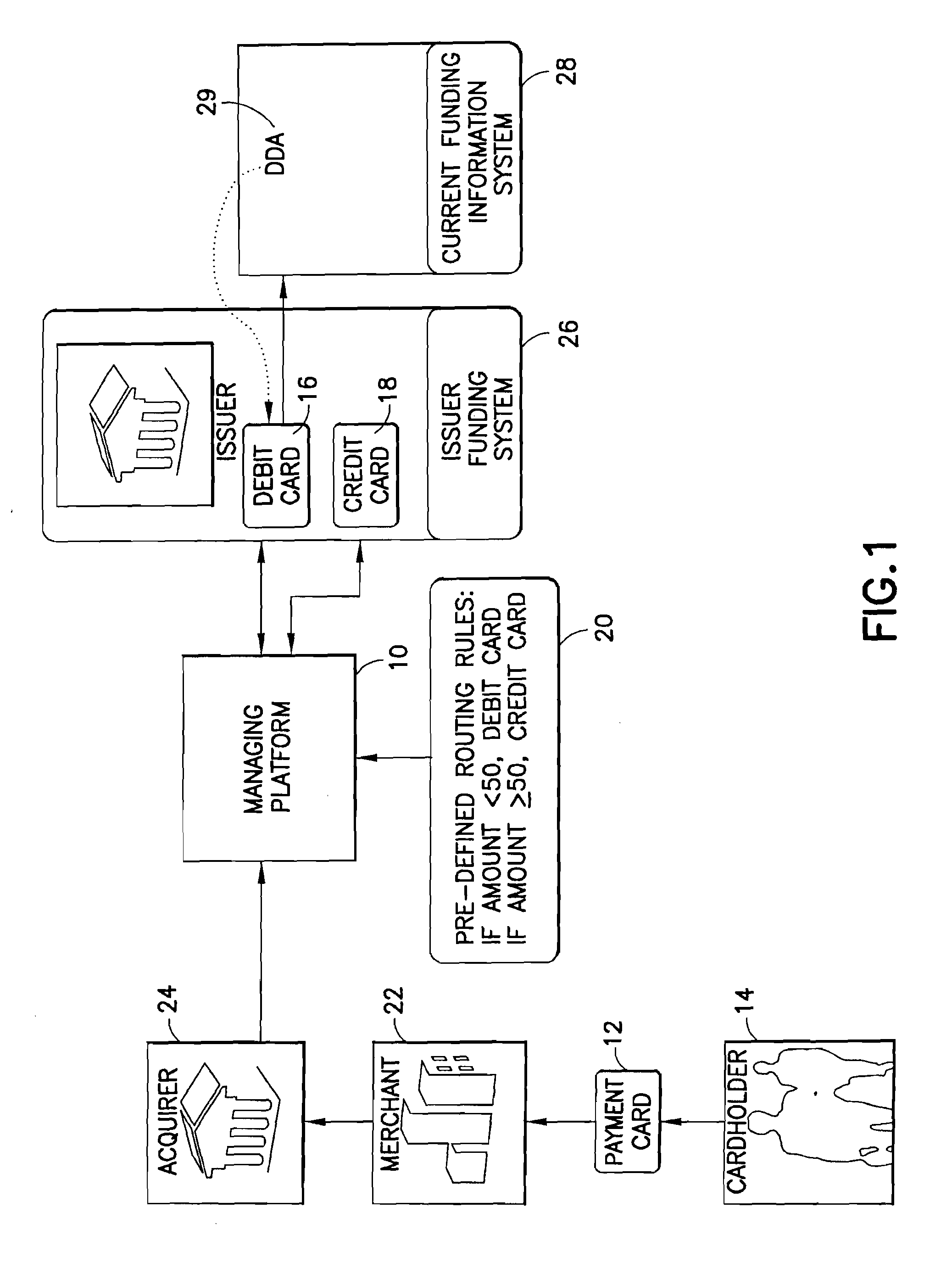

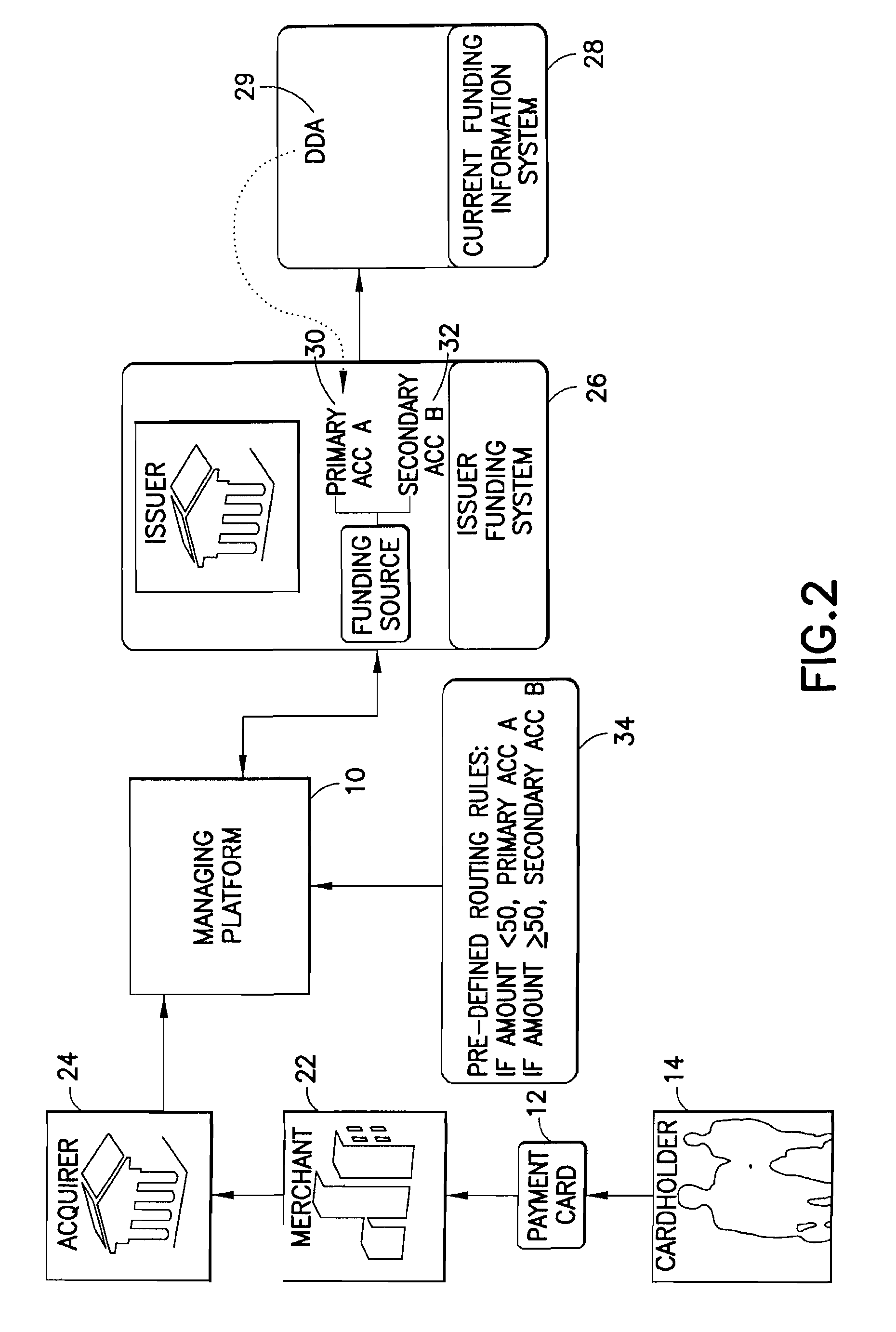

Method for providing a credit cardholder with multiple funding options

A method and a system for providing a payment cardholder with multiple funding source options for a payment card are provided herein. First, a managing platform associates at least two funding sources with the payment card. The funding sources include a first funding source and a second funding source. Next, the first funding source is designated as a default funding source and a set of pre-defined routing rules for funding transactions made with the payment card. Then, the managing platform intercepts each transaction of the payment card and routes the transactions to an issuer funding system for the first funding source using the managing platform.

Owner:MASTERCARD INT INC

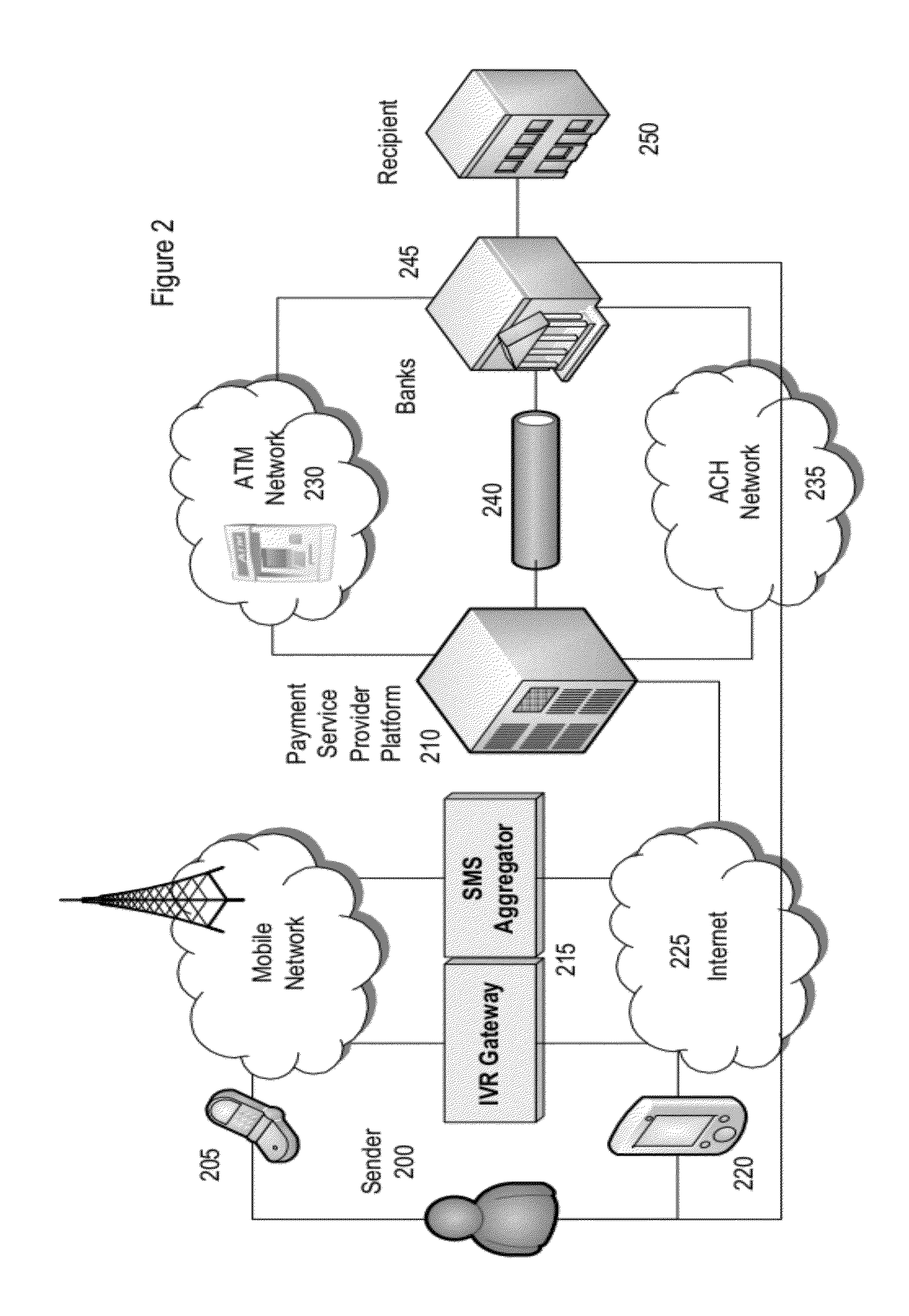

Method & System for Providing Payments Over A Wireless Connection

The present invention relates to a method and system for providing payments over a wireless connection. Instant messaging services—such as mobile text messaging—addressed to a command interpretation and processing system are utilized in conjunction with a checkout procedure on a mobile device to enable a user making a payment to simply define and confirm the amount of his or her payment, and the recipient. The checkout procedure can be completed with SMS, Mobile Web, Mobile App or IVR implementation. Previously Registered as well as new unregistered users are supported. The payer, through his or her mobile device, interacts with a system for managing mobile payment transactions that validates the sender and recipient of the funds, the presence of funds in a transacting account and other fraud management and authentication checks, and effects a settlement. The Sender may chose a variety of funding sources to fund the transaction, while the recipient can receive the funds on a debit or credit account, or immediately in a demand deposit account of their choice. In one embodiment of the present invention the system is used to pay for purchases of goods and services. In another embodiment of the present invention, the system is use to provide donations to charities.

Owner:OBOPAY MOBILE TECH INDIA PTE LTD

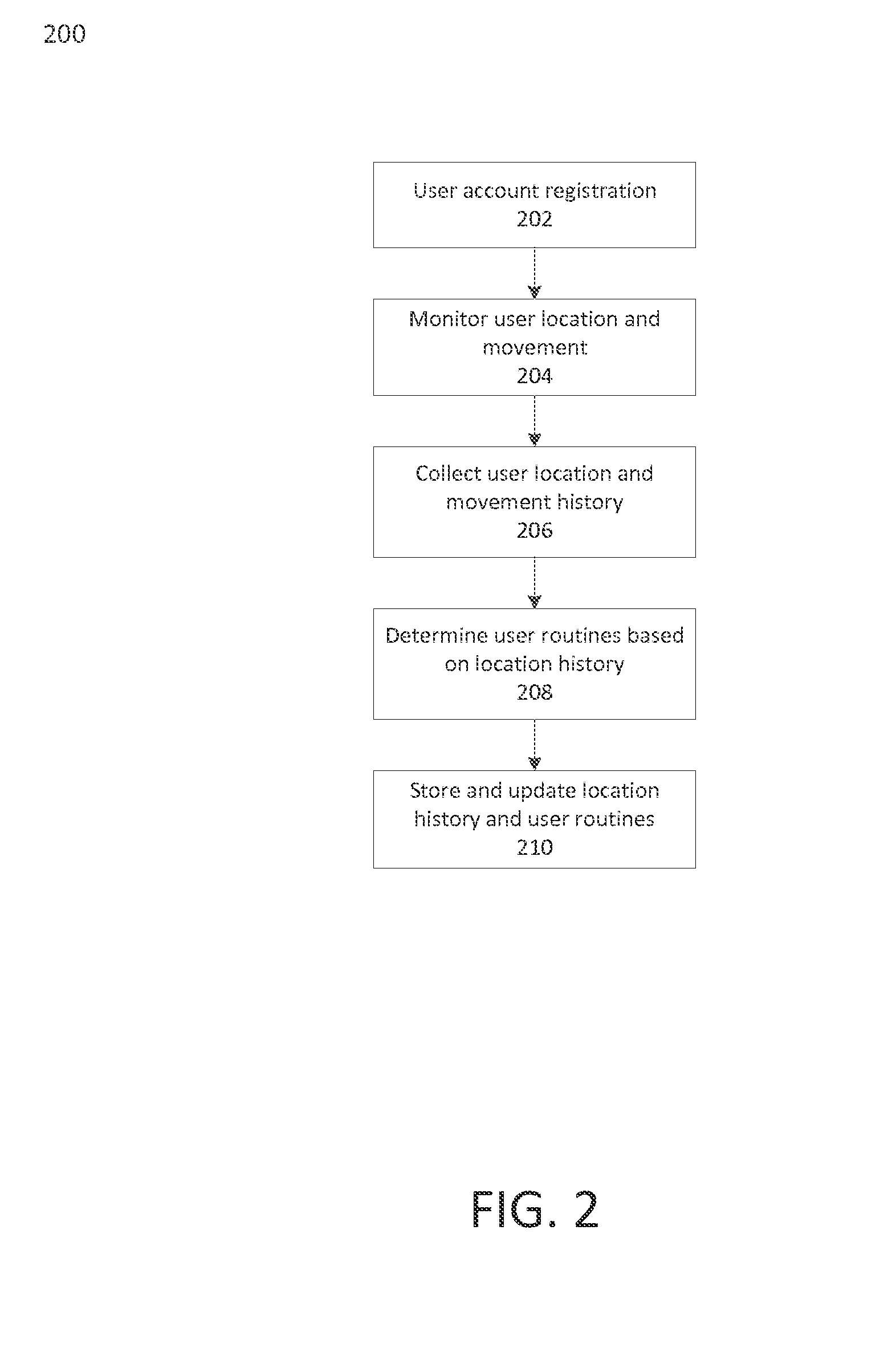

Systems and methods for implementing authentication based on location history

A system and / or method may be provided to authenticate a user based on the user's location history. In particular, the user's past locations and movements may be detected at the user's mobile device. Information with regard to the user's movements and location may be collected and analyzed to determine certain routines, such as locations frequently visited or routes frequently taken. When a payment request is made from the user's mobile device, the mobile device's recent location history may be compared with the routines of the user. A confidence score may be generated based on the user's recent location history. The confidence score may be used to authenticate the user for the payment request. In an embodiment, the confidence score may be used to determine the transaction fee for using a certain funding source, such as a credit card.

Owner:PAYPAL INC

Methods and systems for opening and funding a financial account online

Owner:FIDELITY INFORMATION SERVICES LLC

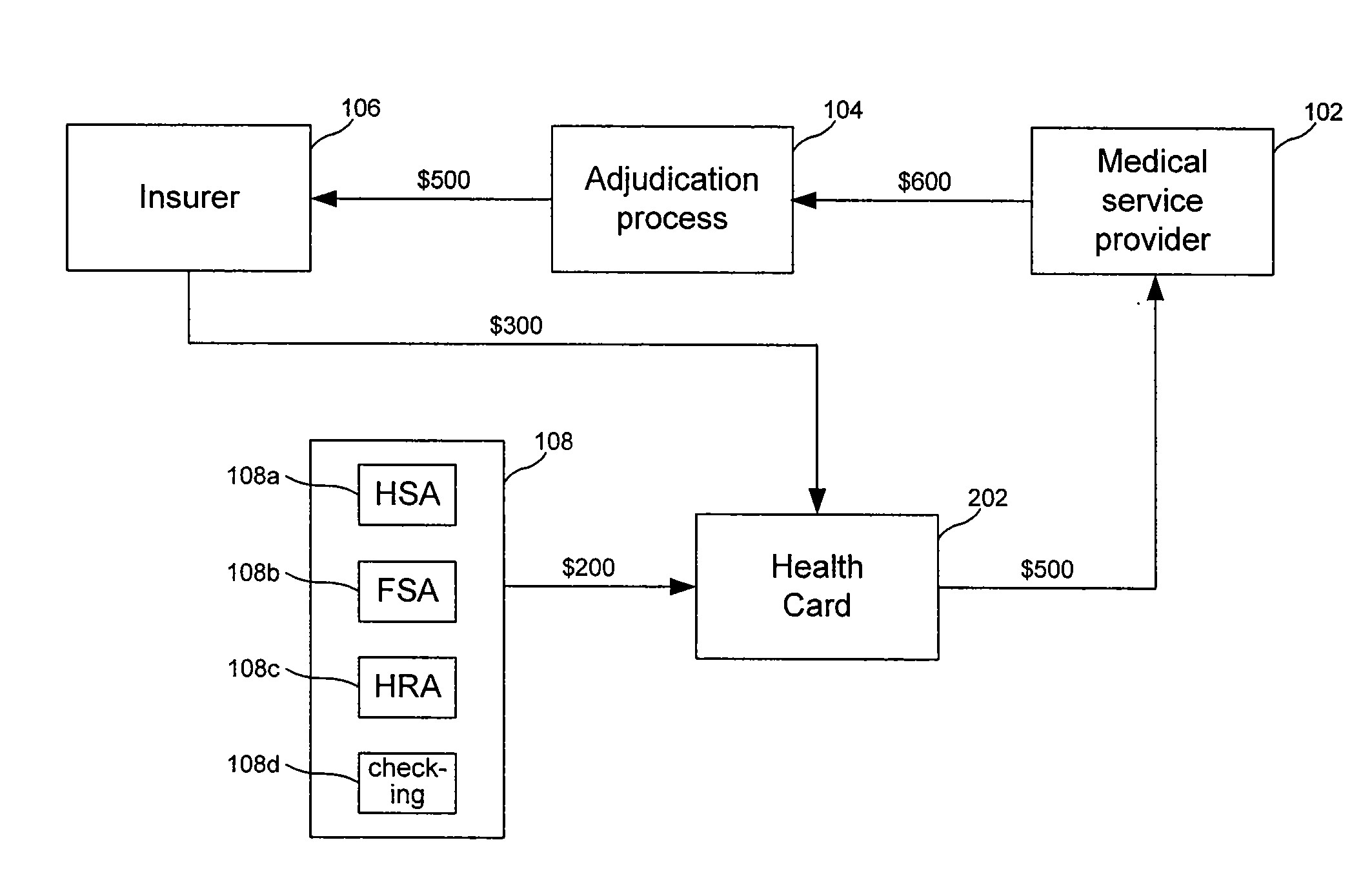

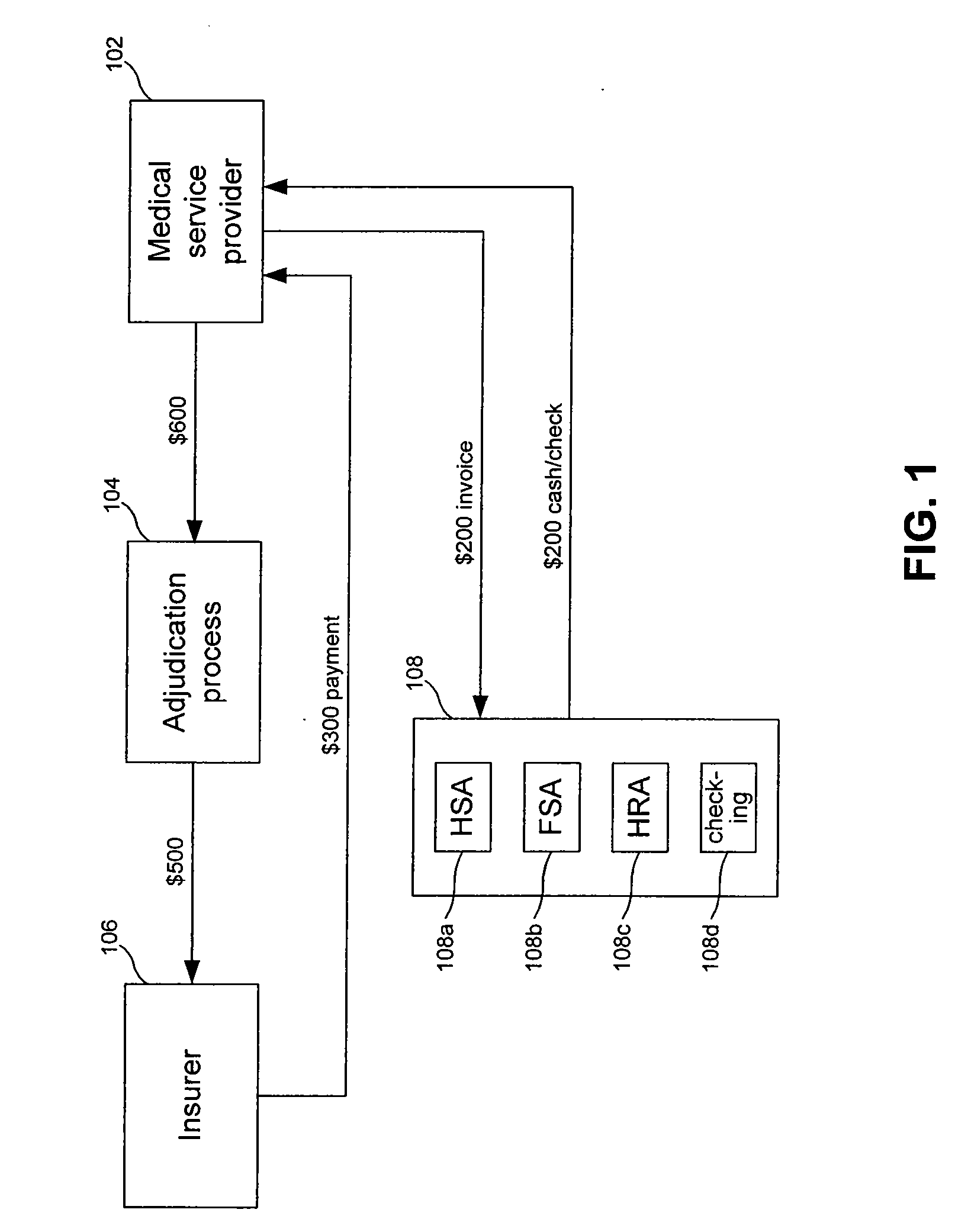

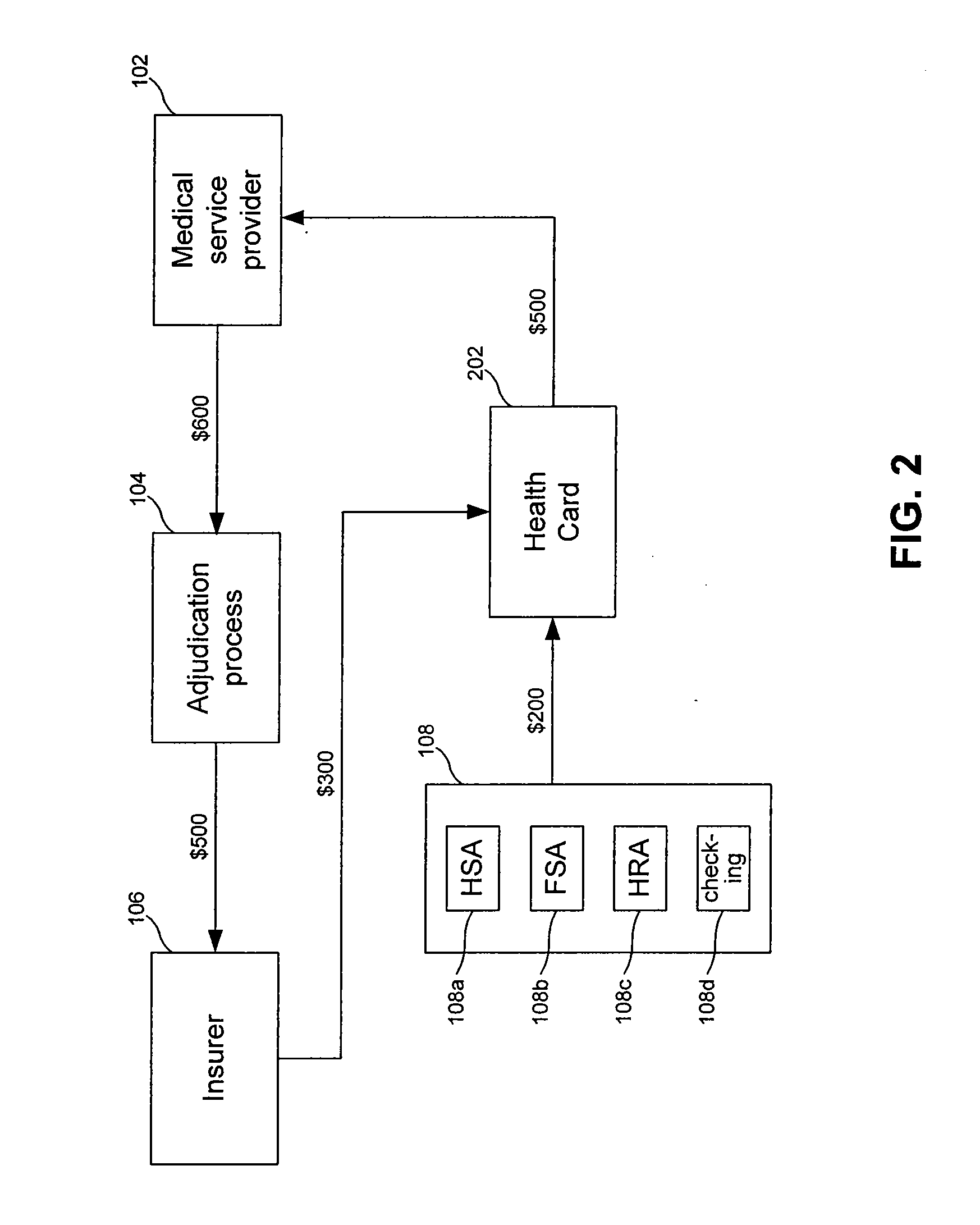

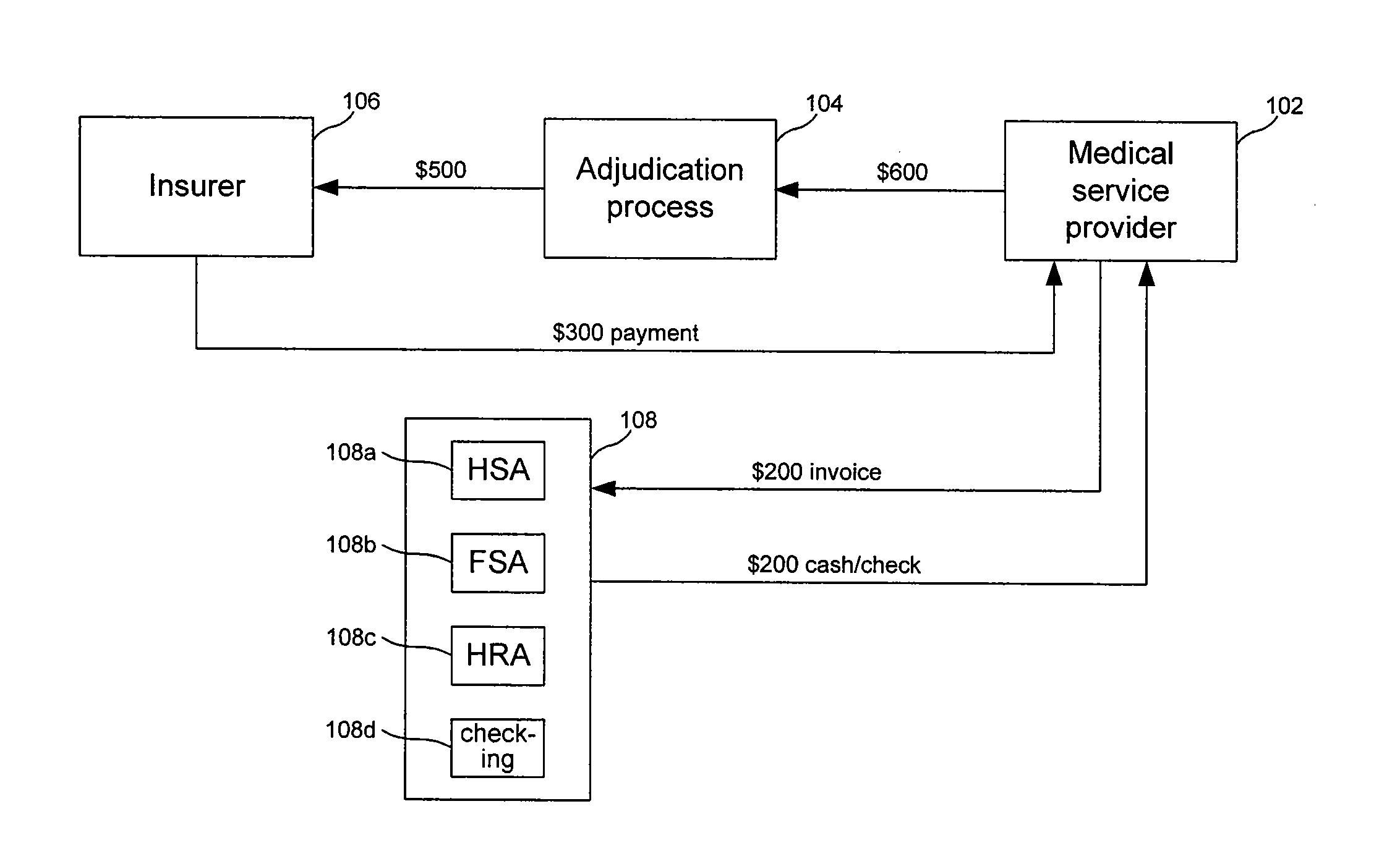

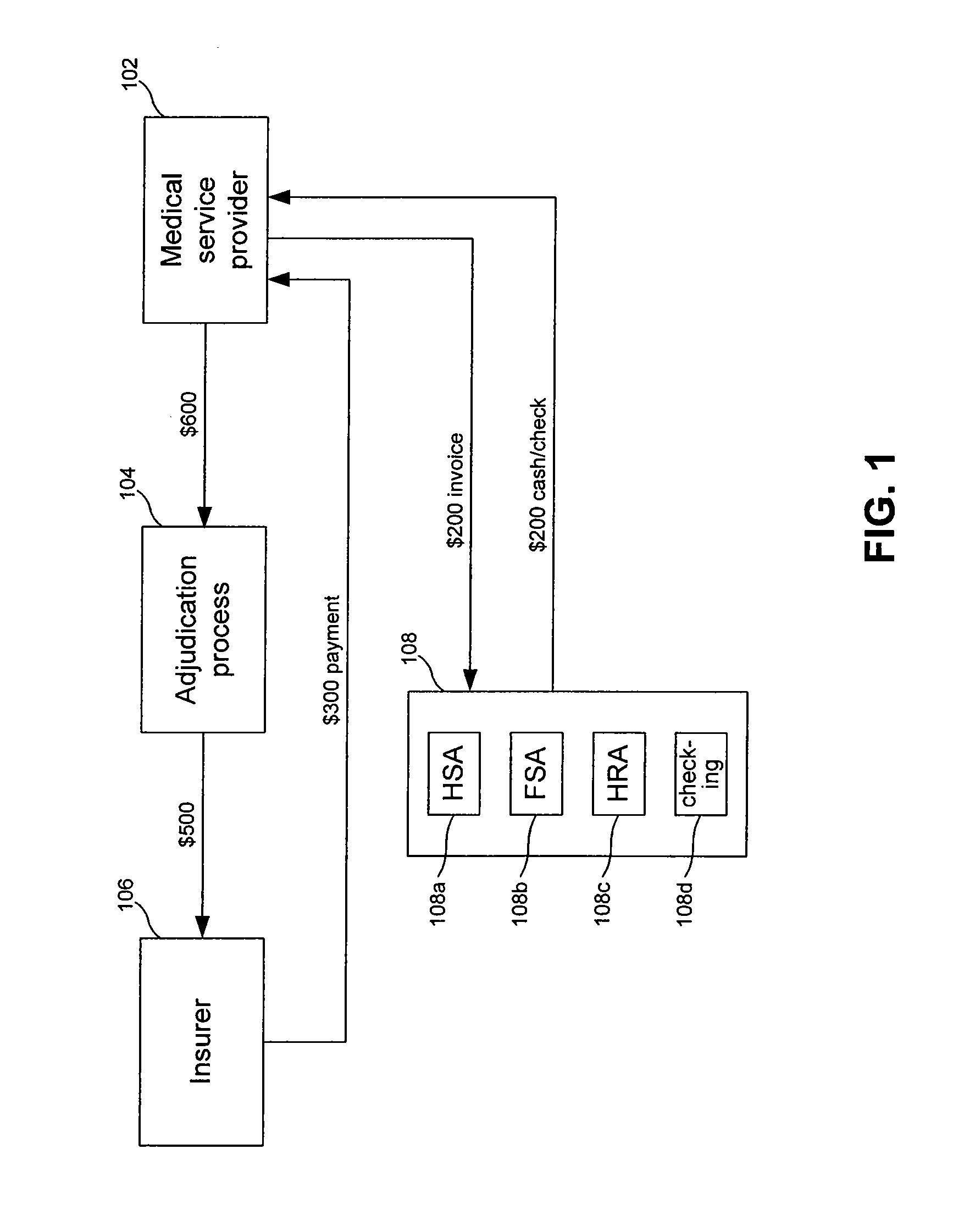

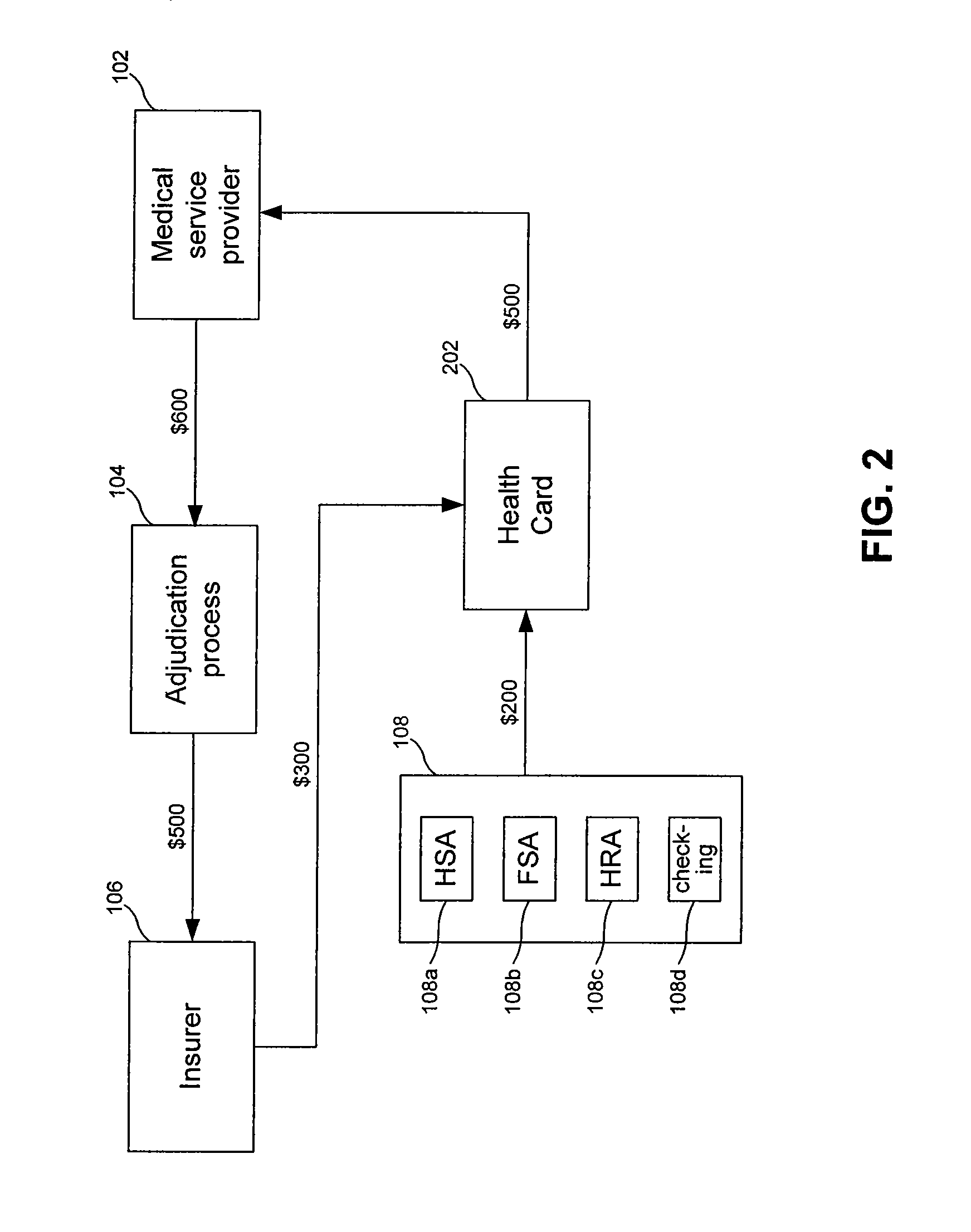

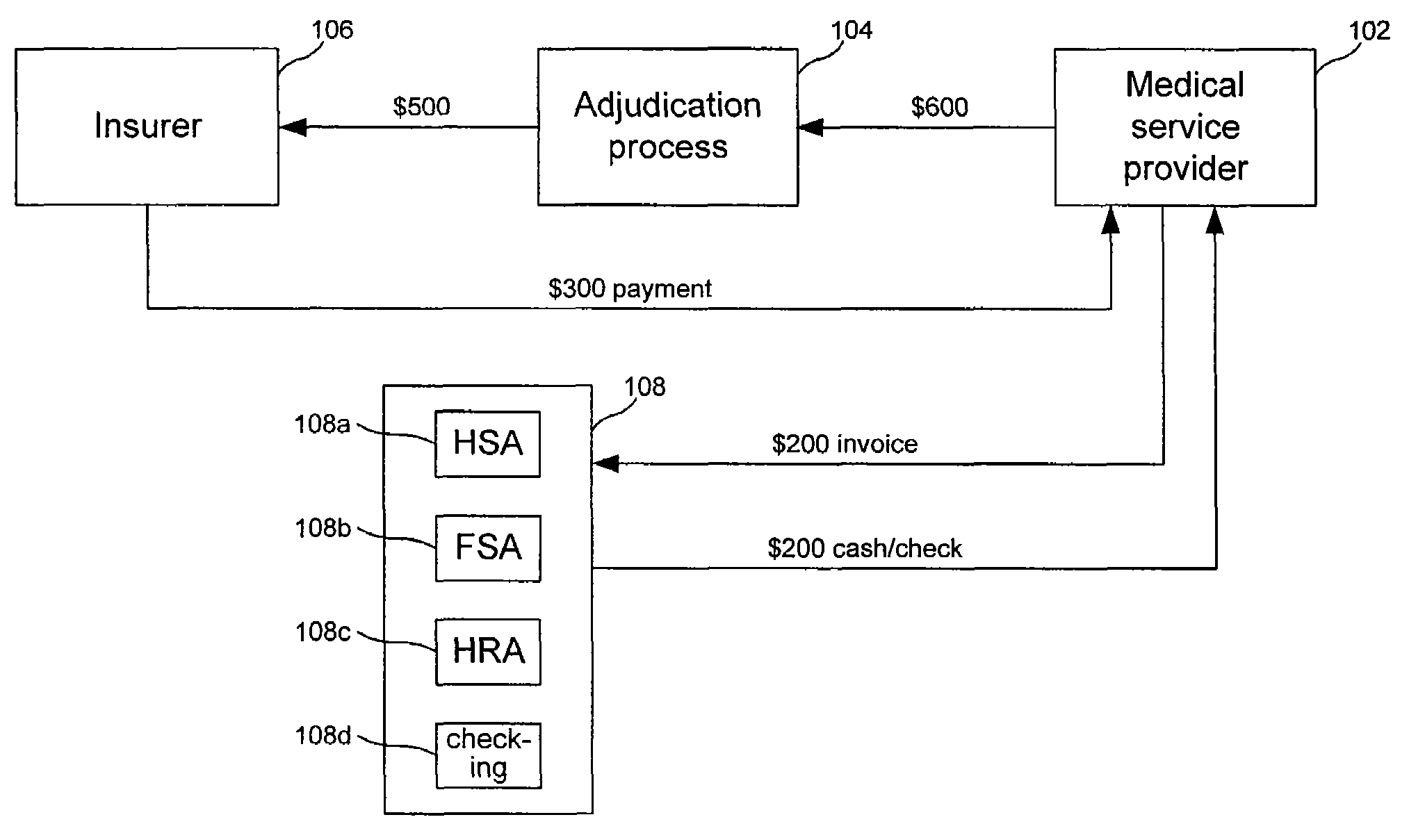

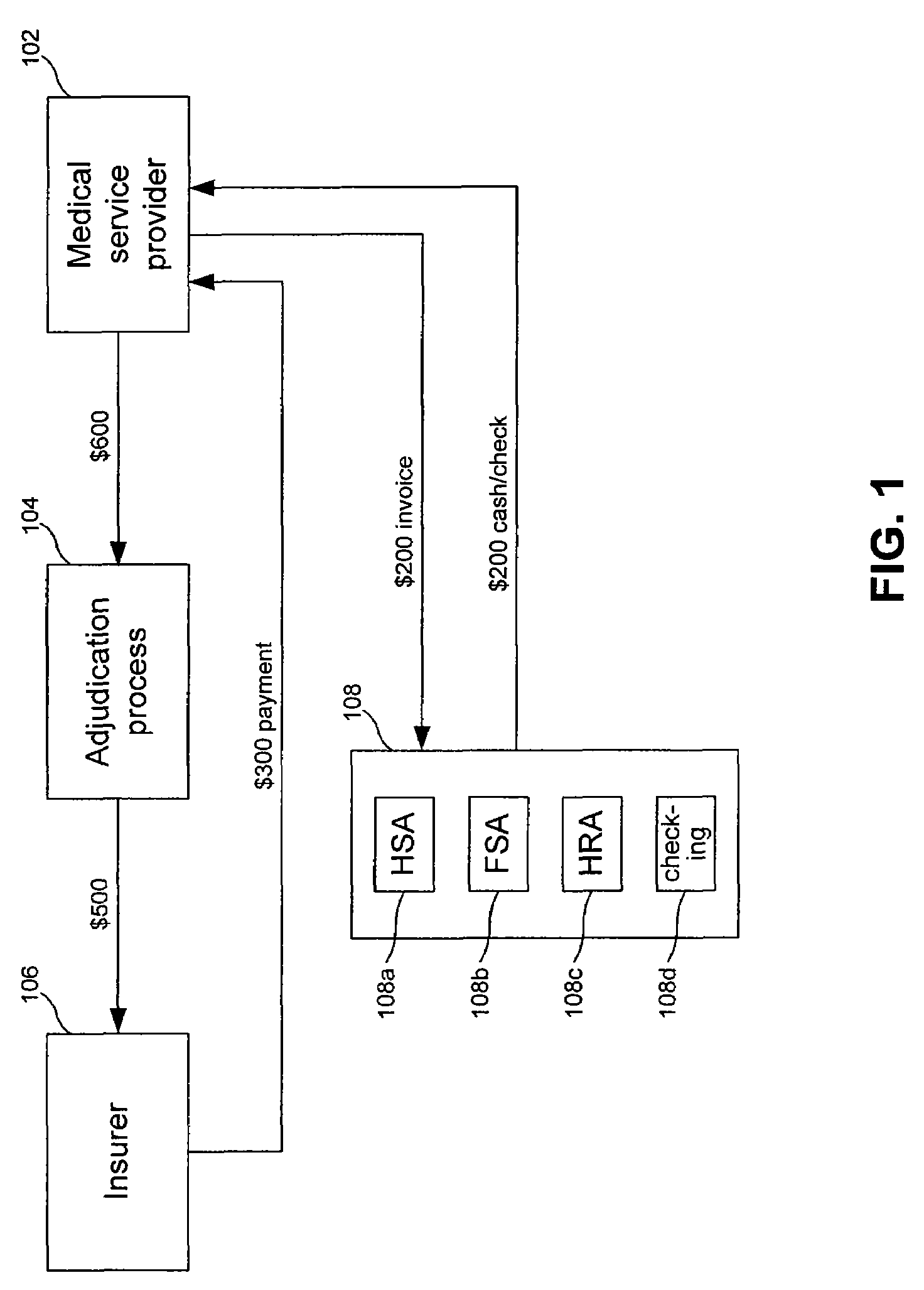

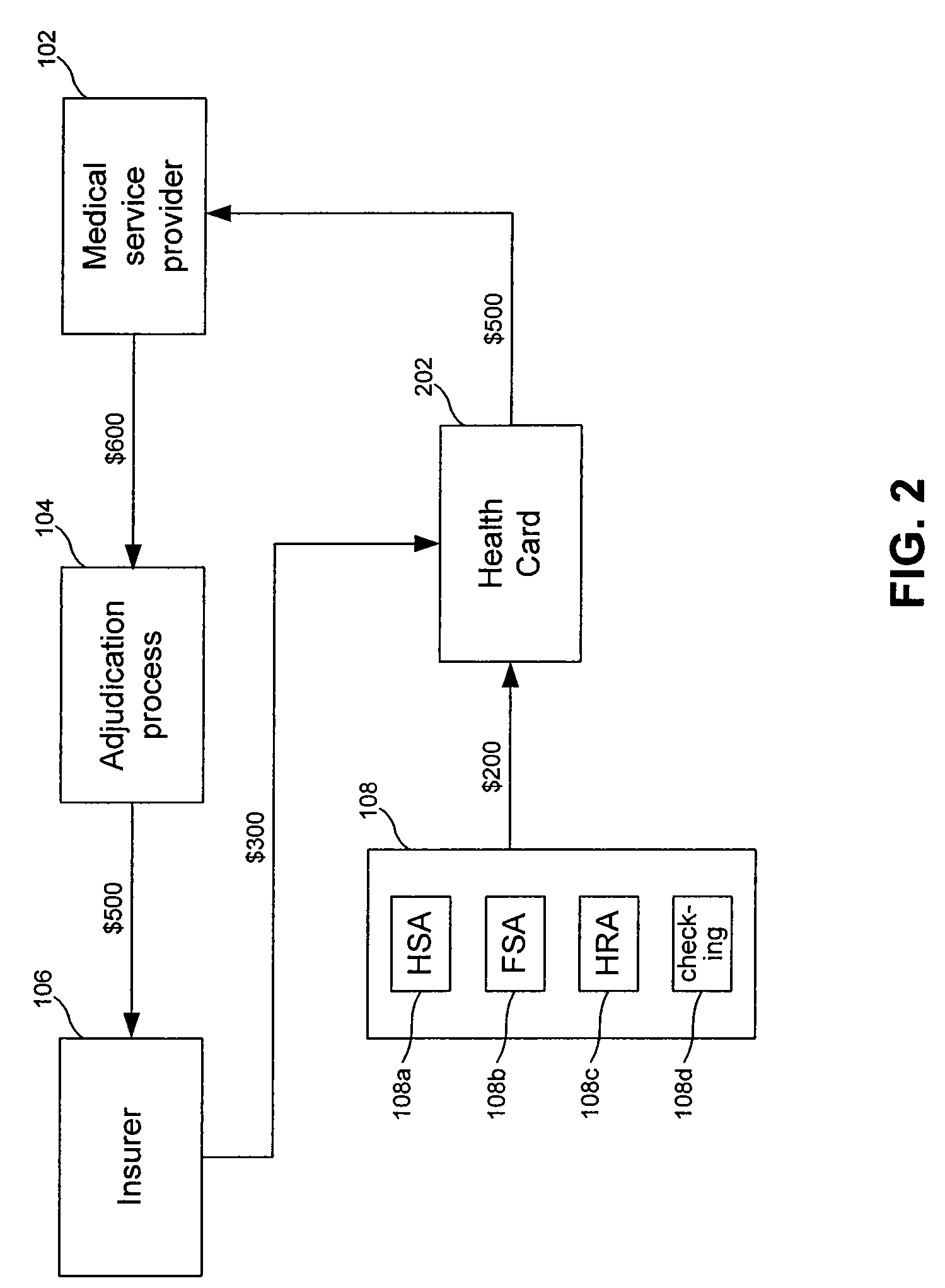

Healthcare Card Closed Loop Network System

A method comprises the steps of: receiving, at a host computer, a request from a provider for payment for a charge incurred by a purchaser; identifying a plurality of funding sources of the purchaser from which to draw funds for payment of the charge; and causing at least one of the plurality of funding sources to be debited for at least a portion of the purchasing amount of said item based on said payment authorization.

Owner:LIBERTY PEAK VENTURES LLC

Systems and Methods to Process Payments

Systems and methods are provided to facilitate online transactions via mobile communications. In one aspect, a system includes a data storage facility and an interchange coupled with the data storage facility that stores data associating a phone number with an account, such as a balance of the account, identification information of a plurality of funding sources, and security data for authentication. The interchange includes a common format processor and a plurality of converters to interface with a plurality of different controllers of mobile communications. The converters are configured to communicate with the controllers in different formats and with the common format processor in a common format, to facilitate authentication of the payment requests received from various payment terminals. The requests are authenticated via both the security data and communications with a mobile phone having the phone number. After the authentication, the payments are effected using the account.

Owner:BOKU

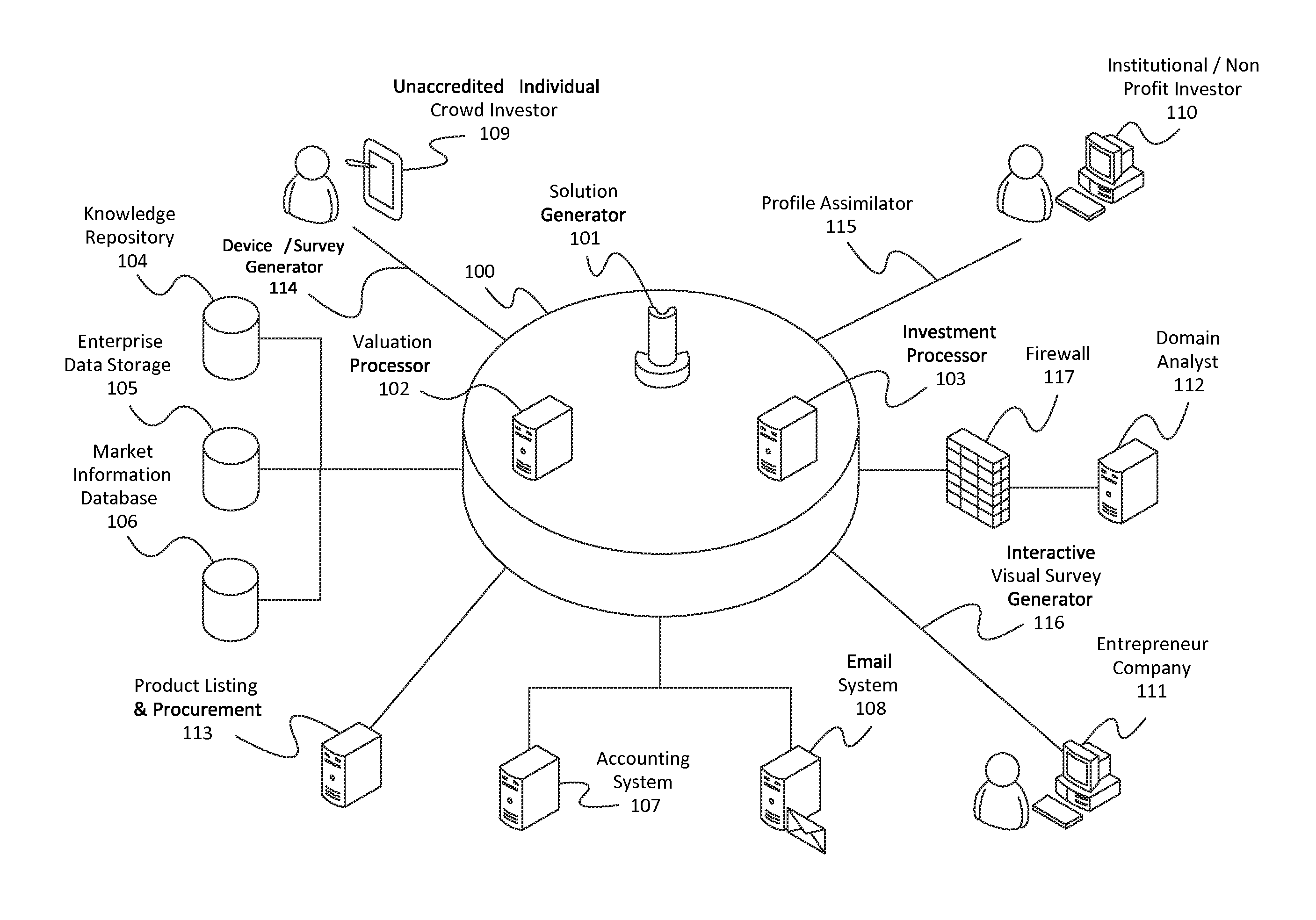

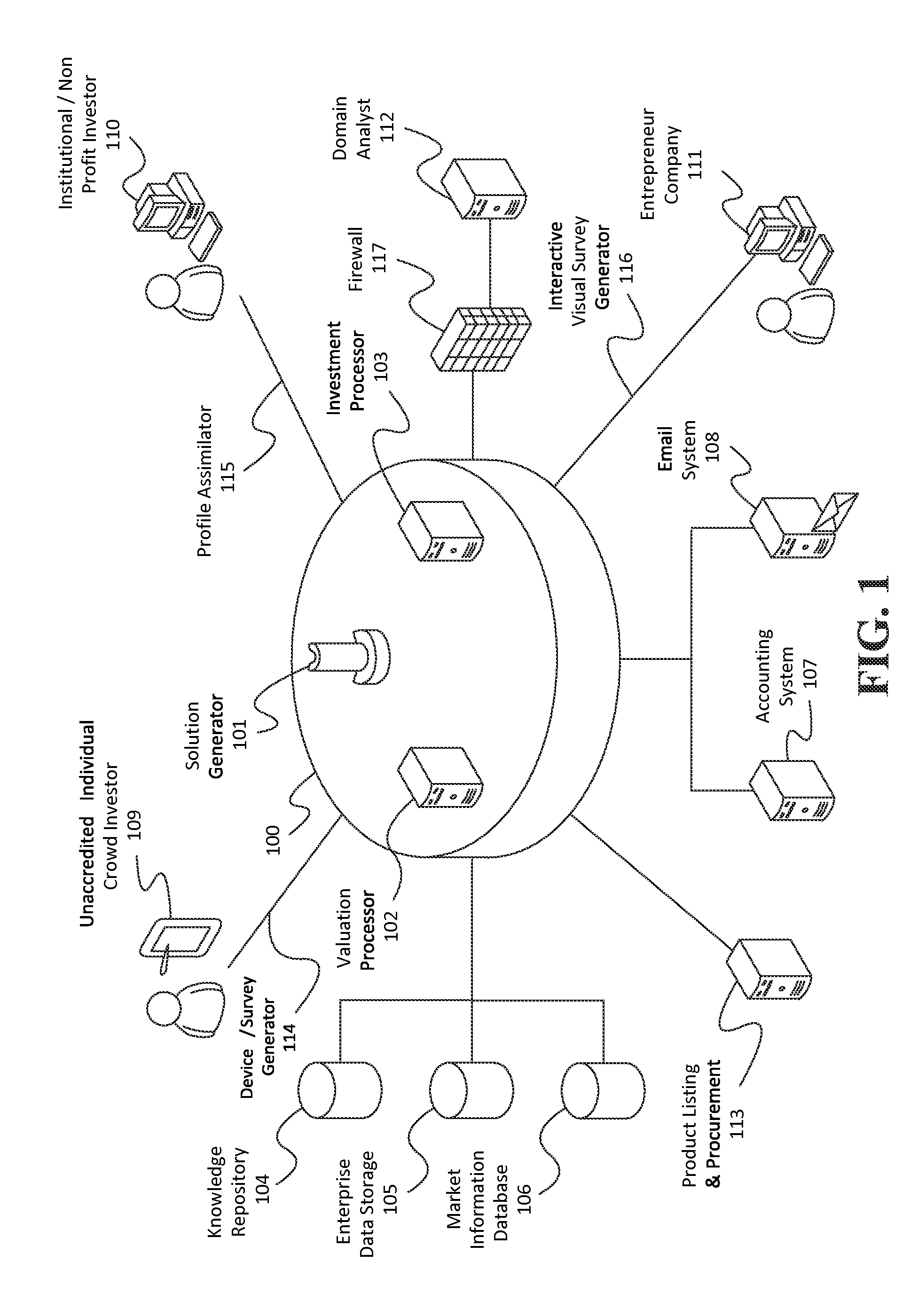

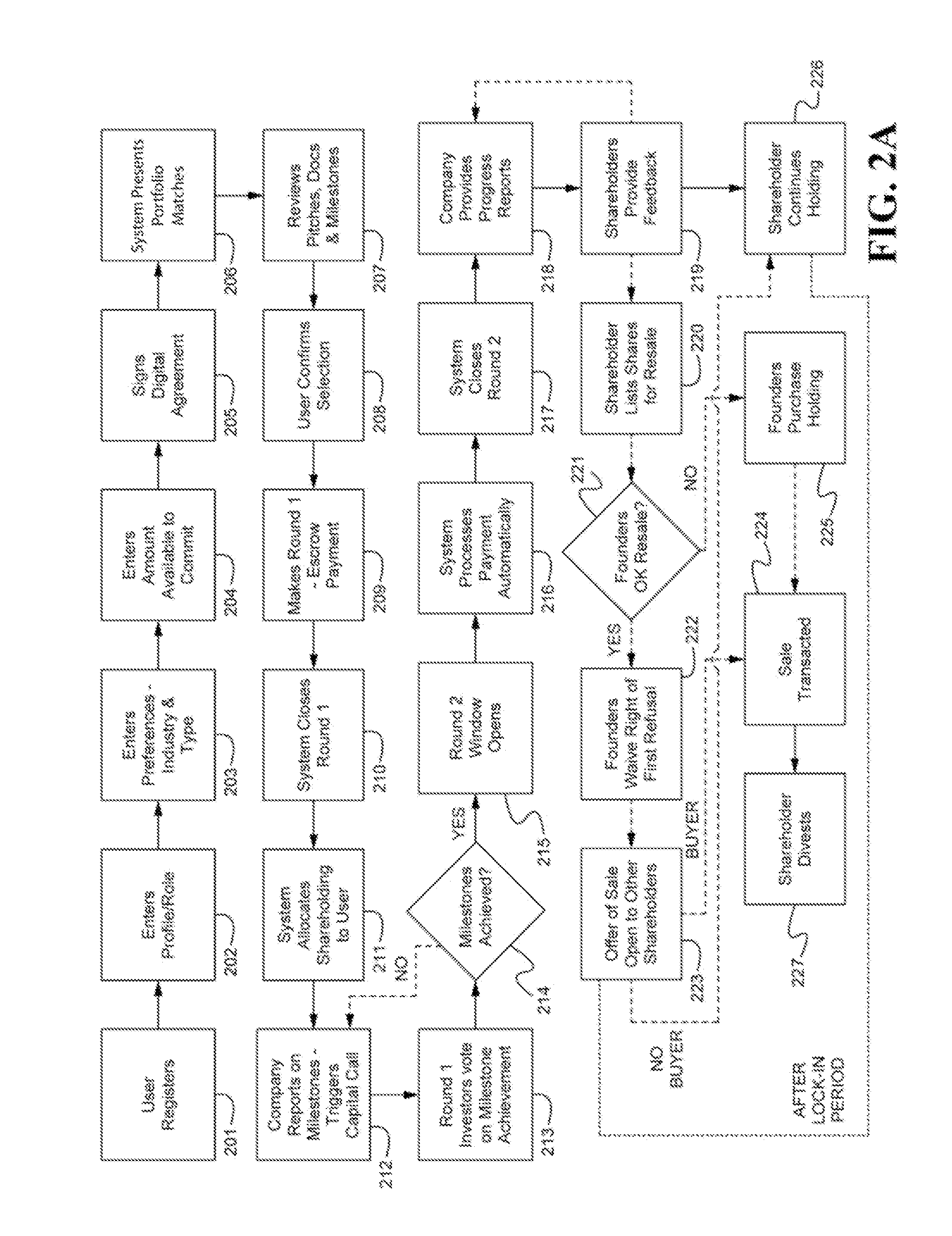

Systems and Methods for Equity Crowd Funding

A method of recommending a business for investment receives information about an investor from a crowd funding source. The method creates a group of investor data from the information about the investor. The group of investor data corresponds to a profile of the investor. The method also receives information about a plurality of businesses and creates groups of business data from the information about the plurality of businesses. Further, the method determines a plurality of relationship values. The relationship values are based on the group of investor data and the groups of business data. Each relationship value corresponds to a relationship between the investor and a unique business. The method selects a business for an investment recommendation based on the relationship value between the investor and the business.

Owner:BLAZEFUND

Assured Payments for Health Care Plans

A method comprises the steps of: receiving, at a host computer, a request from a purchaser for payment authorization for a charge for an item; determining whether said item qualifies for payment of a discounted amount of the item charge; receiving at the host computer a request from a provider for payment of the item charge; identifying a funding source of the purchaser from which to draw funds for payment of the item charge; and causing the funding source to be debited for at least a portion of the discounted amount of the item charge based on the payment authorization.

Owner:OLTINE ACQUISITIONS NY +1

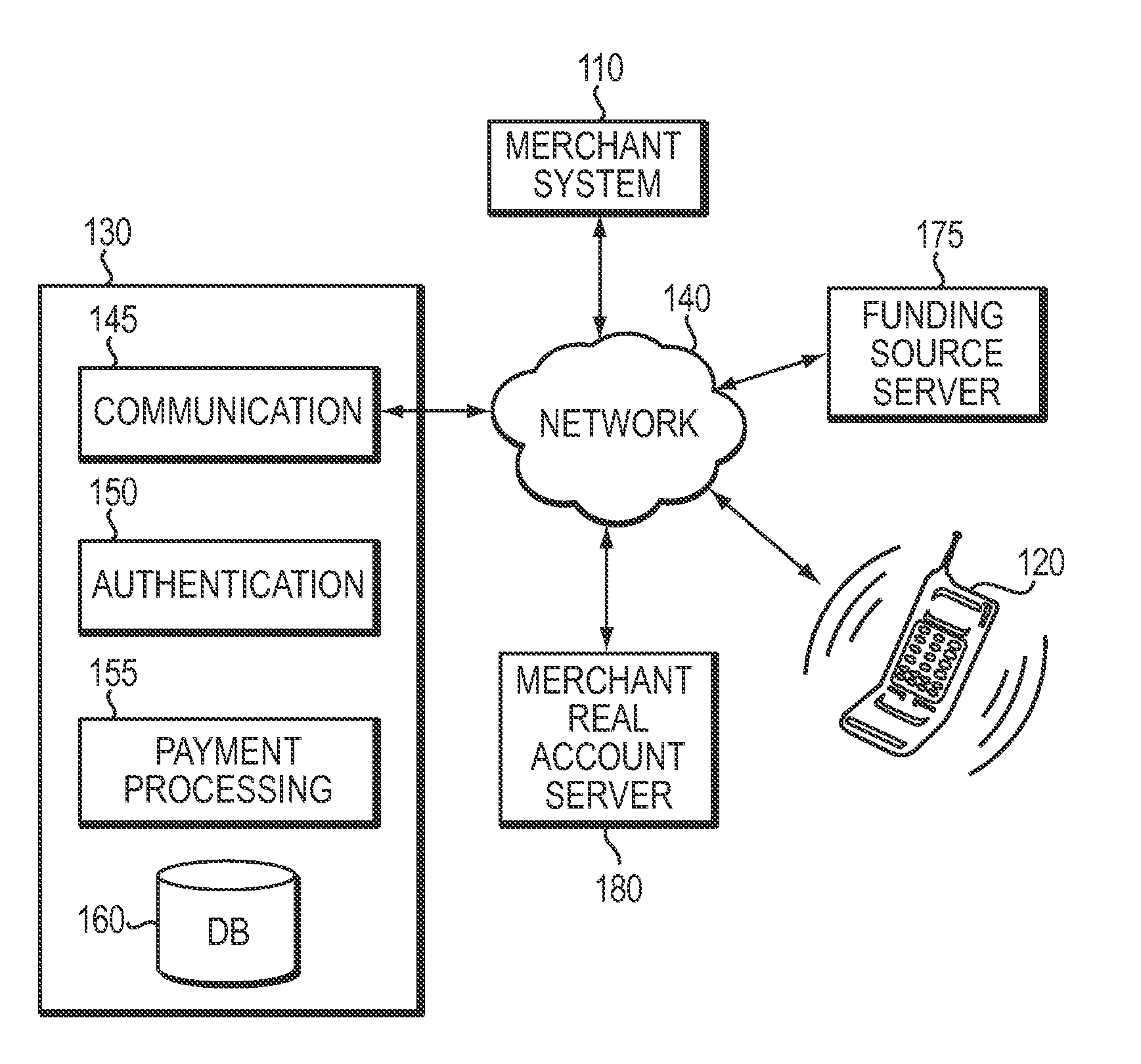

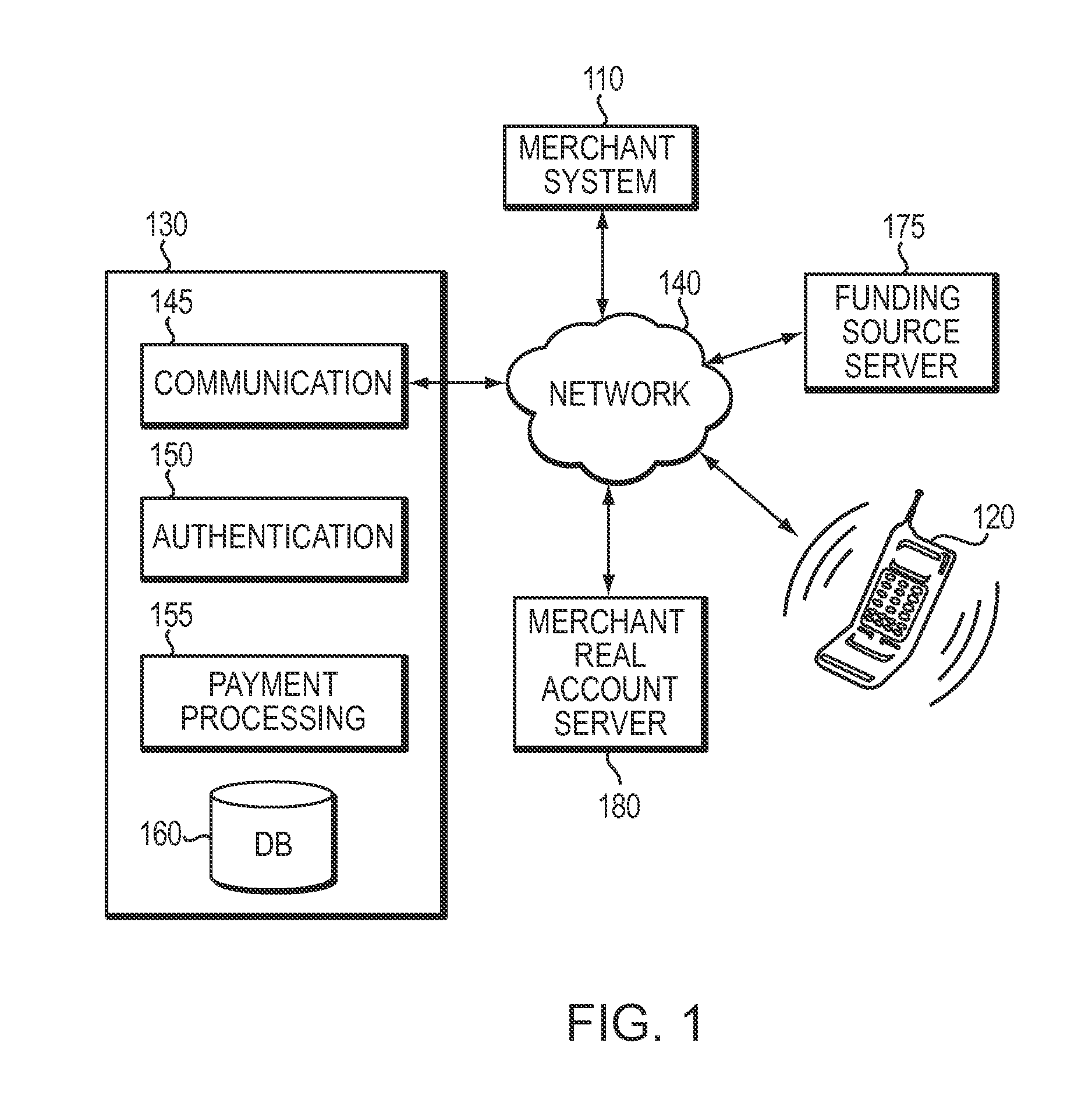

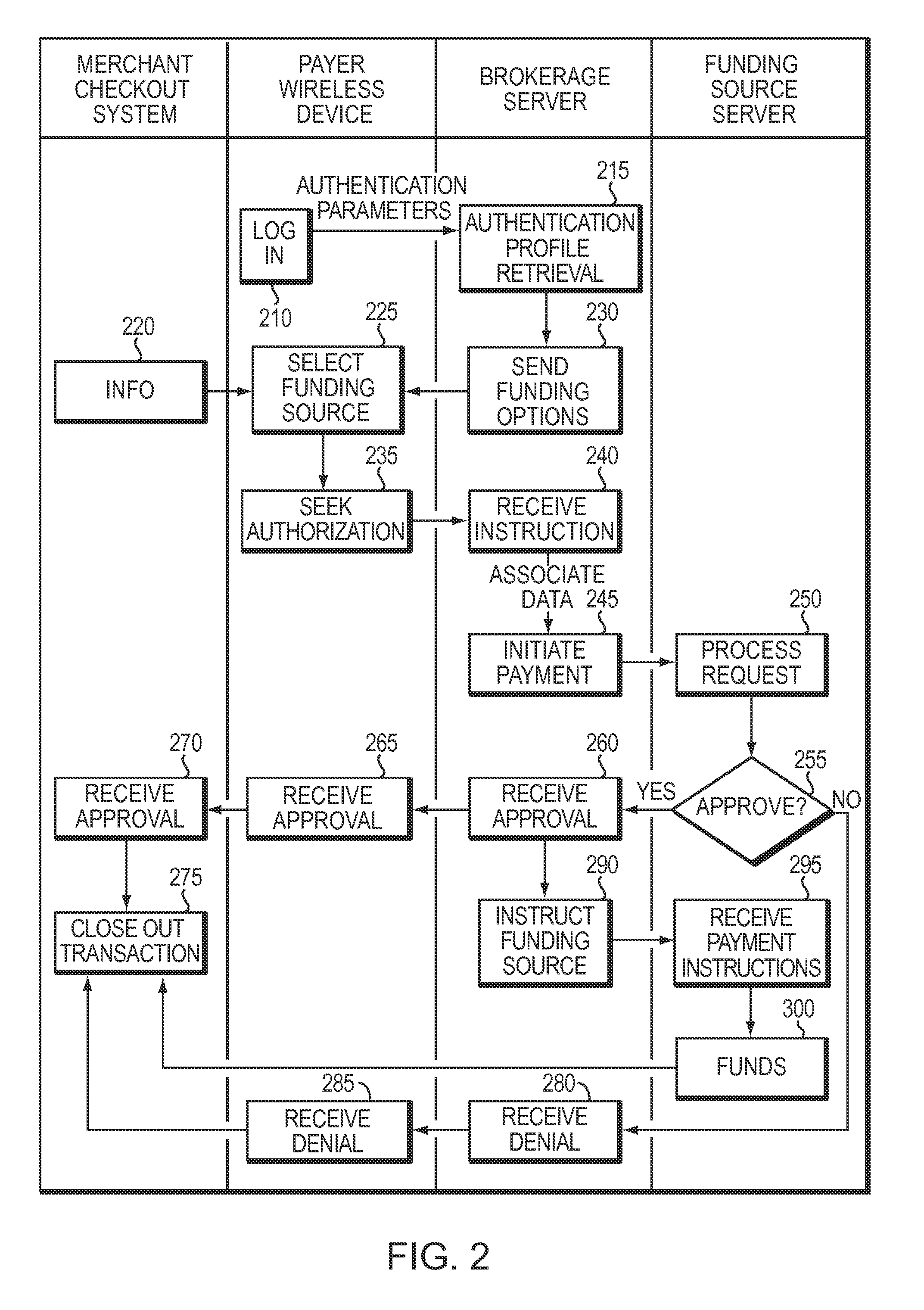

Broker-mediated payment systems and methods

InactiveUS20120259781A1Facilitates fundingEasy transferFinanceProtocol authorisationPayment transactionPayment order

In certain embodiments of systems and methods for conducting payment transactions between a payer and a payee, the payer selects one or more payment sources from various funding sources and accounts available to the payer, and instructs a payment broker's server to perform payment authorization and / or payment routing and clearing services on the payer's behalf. The payment broker's server notifies the payer and / or the payee of the payment authorization status and, if approved, instructs the funding source to send the payment to or for the payee without divulging the payer-selected funding source or account to the payee.

Owner:FOTEC GRP

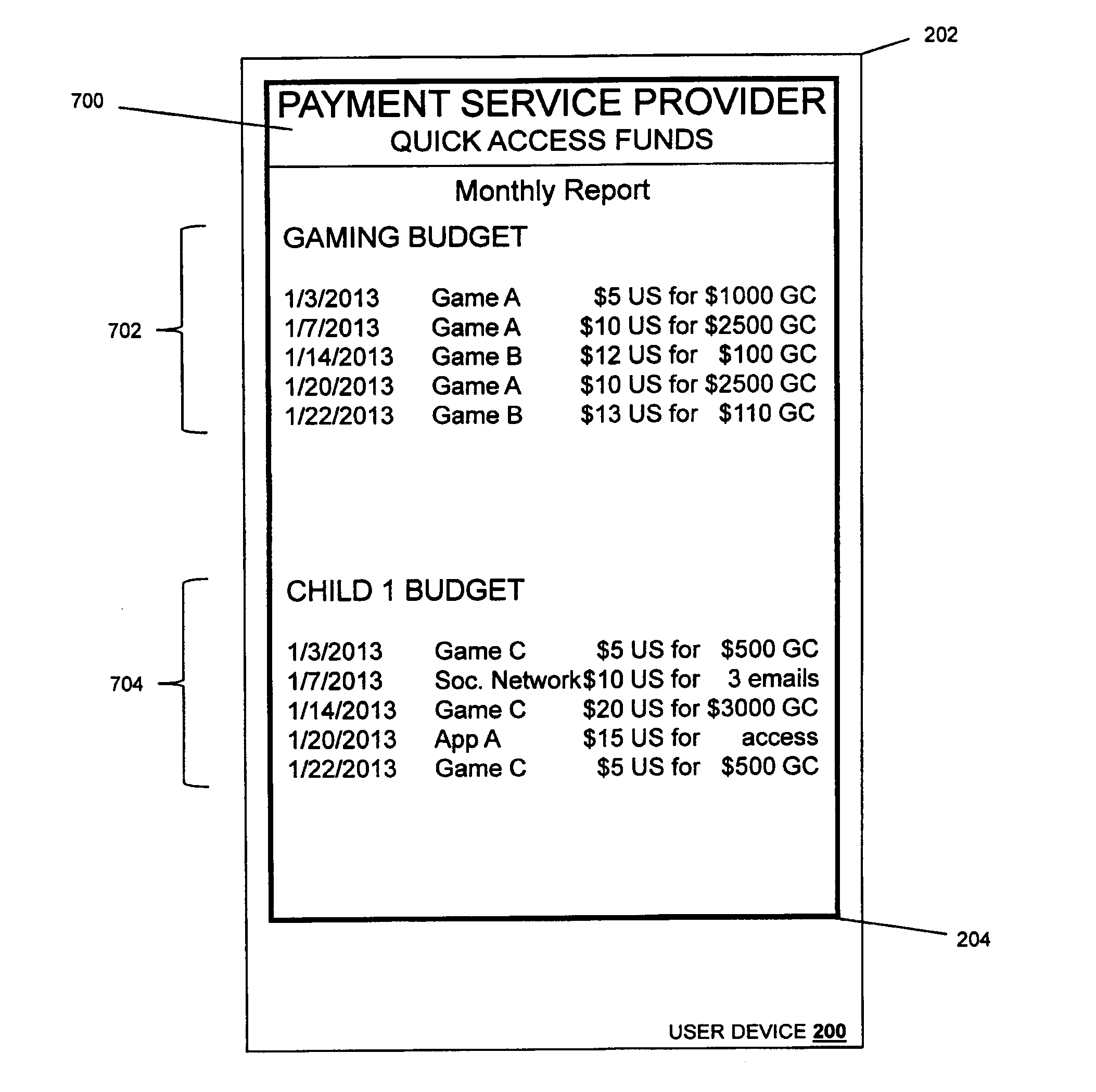

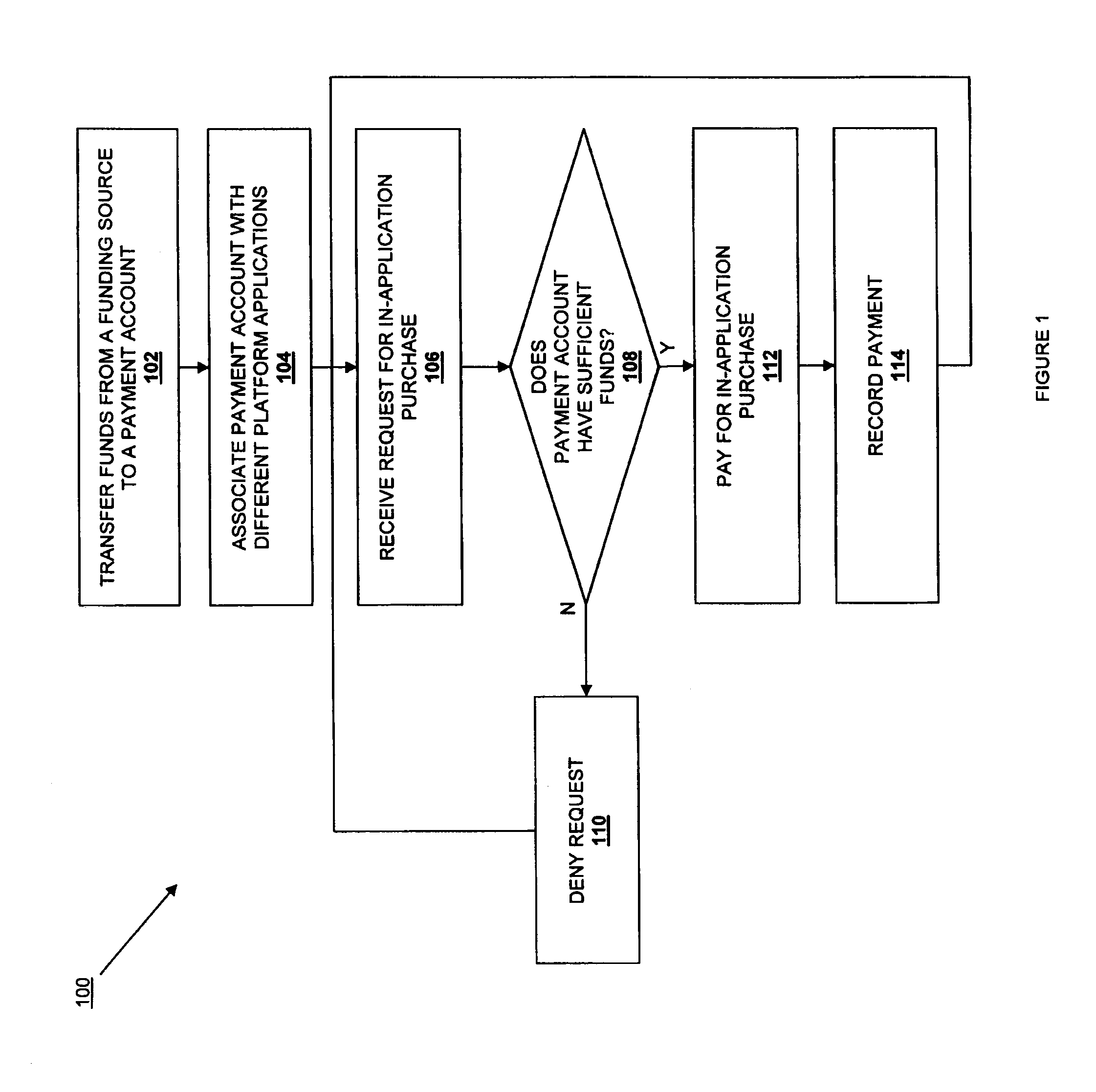

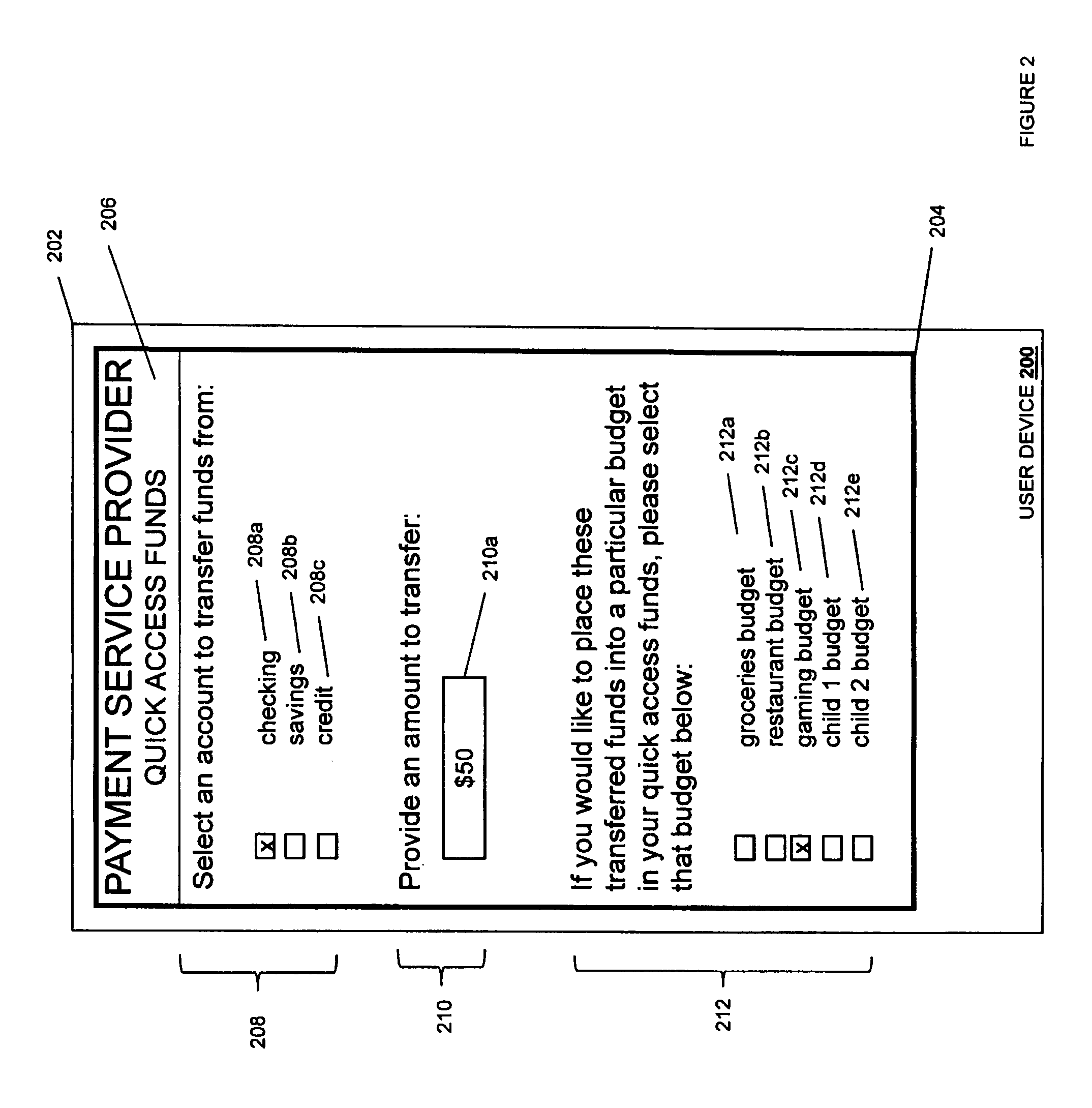

Multi-platform in-application payment system

Systems and methods for providing multi-platform, in-application payments include transferring funds, by a payment service provider device, from a funding source to a payment account in response to receiving a first fund transfer instruction from one of a first user device and a second user device over a network. The payment service provider device then associates the payment account with a first platform application in response to receiving a first association instruction from the first user device over the network, and associates the payment account with a second platform application in response to receiving a second association instruction along with the user account information from a second user device over the network. The payment service provider device will pay for each of a first in-application purchase associated with the first platform application and a second in-application purchase associated with the second platform application using the payment account.

Owner:PAYPAL INC

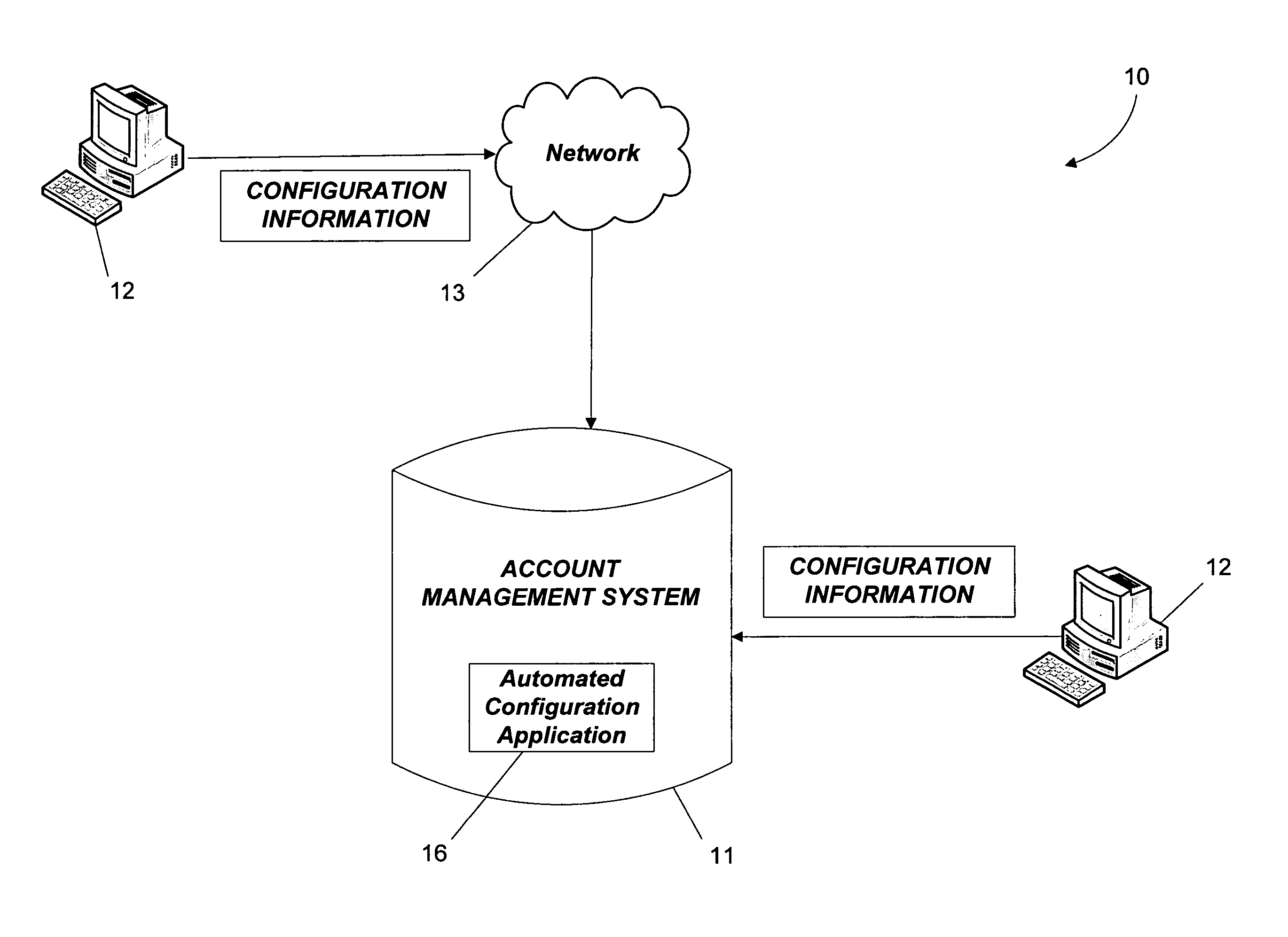

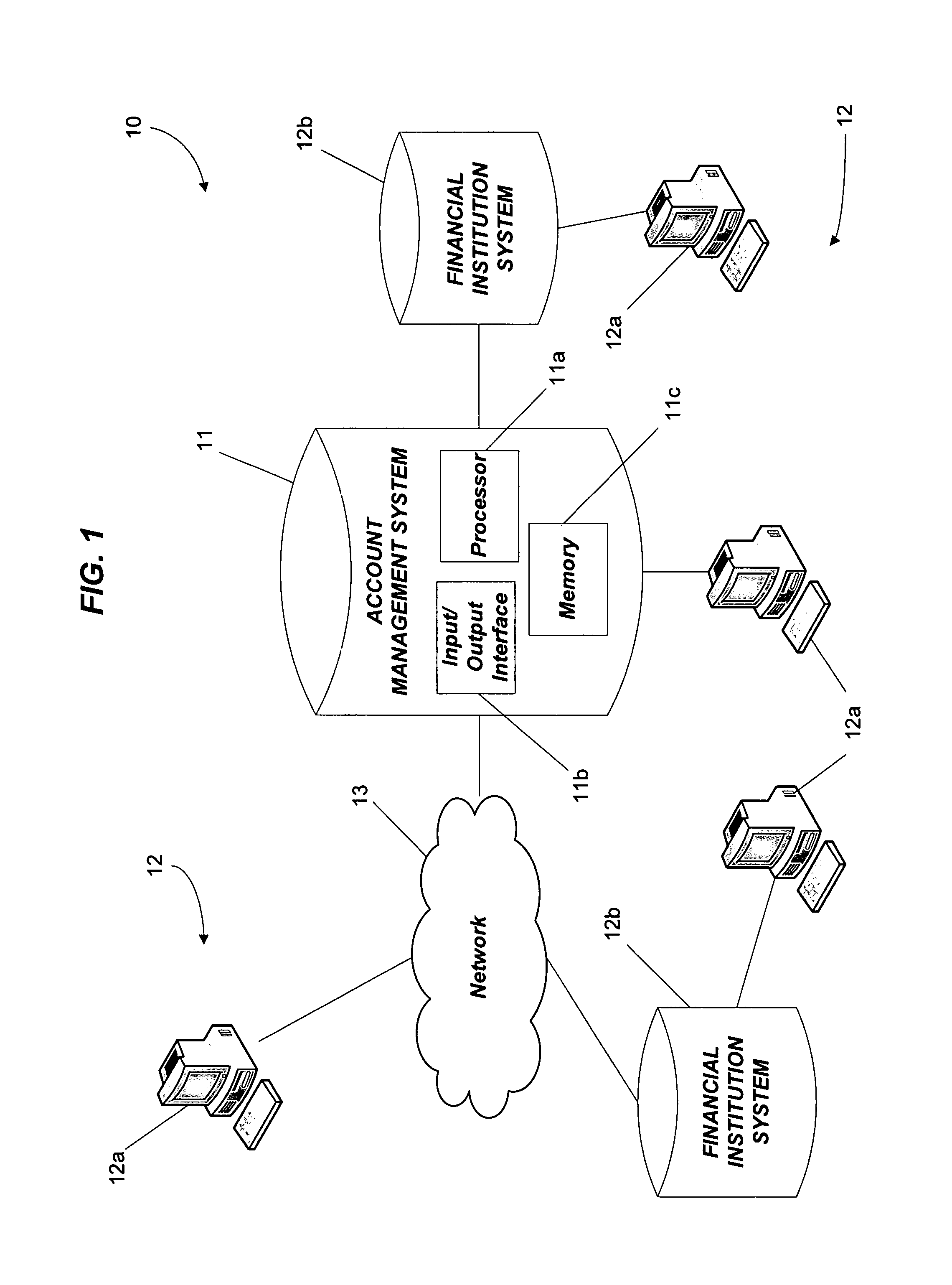

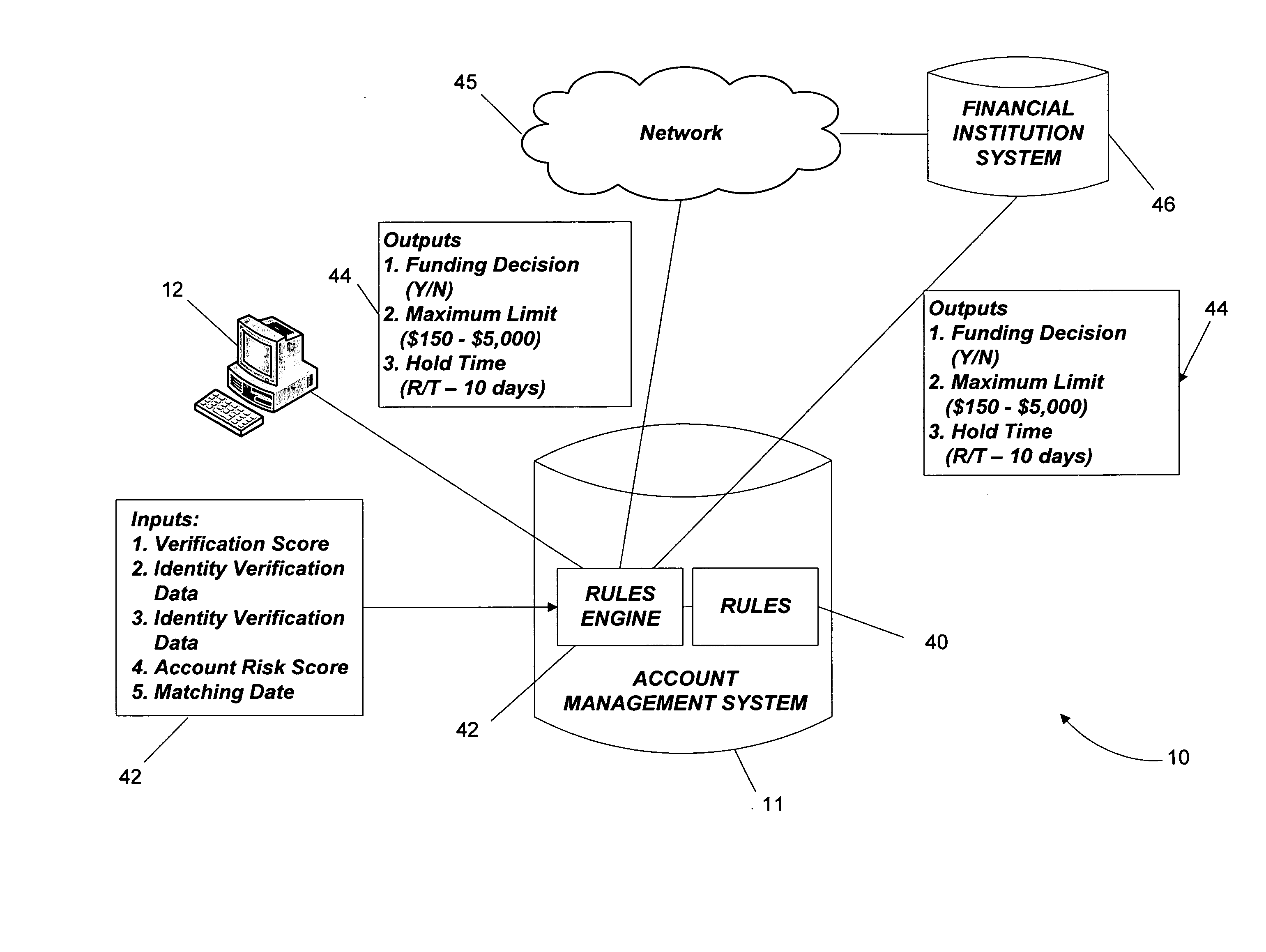

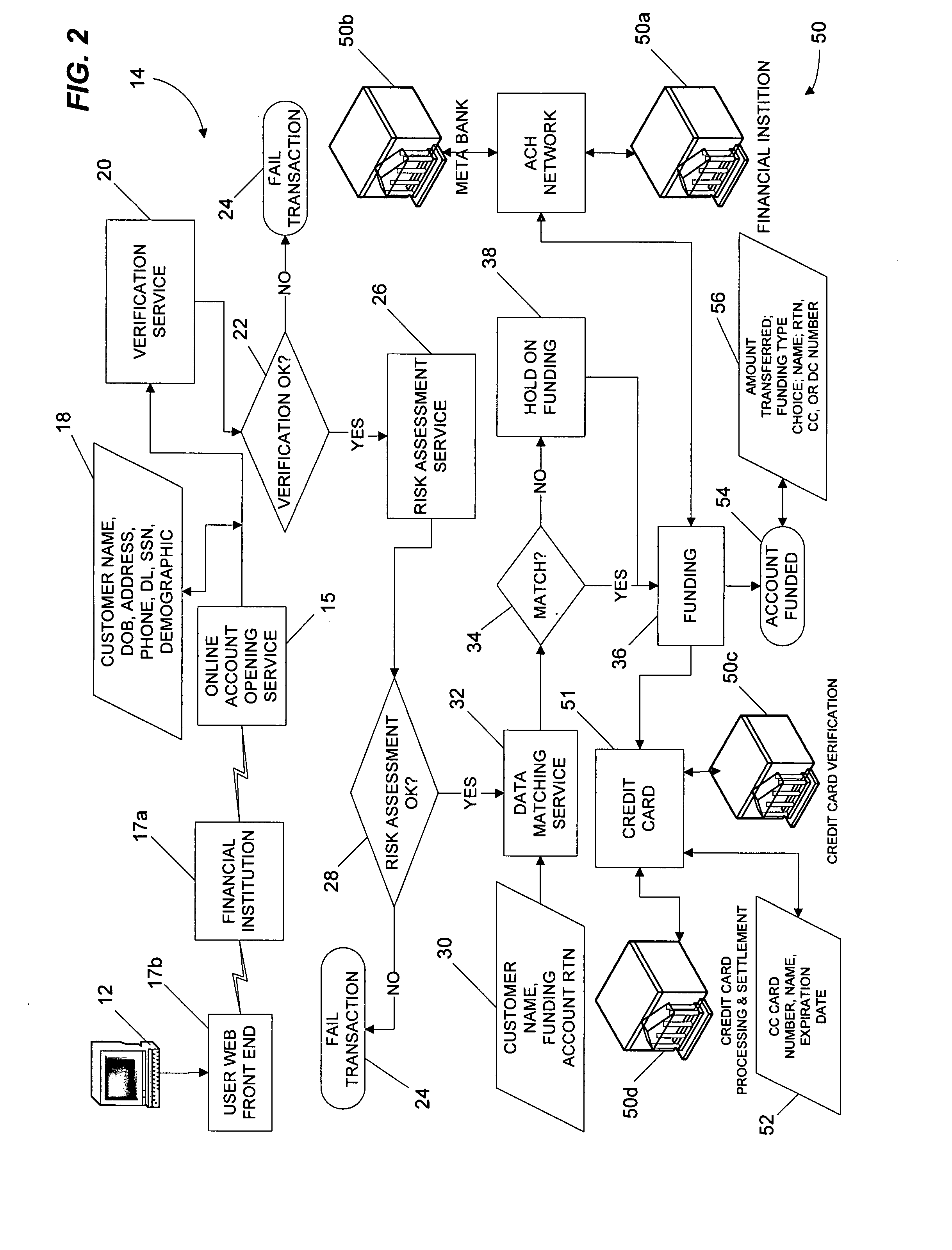

Methods and systems for opening and funding a financial account online

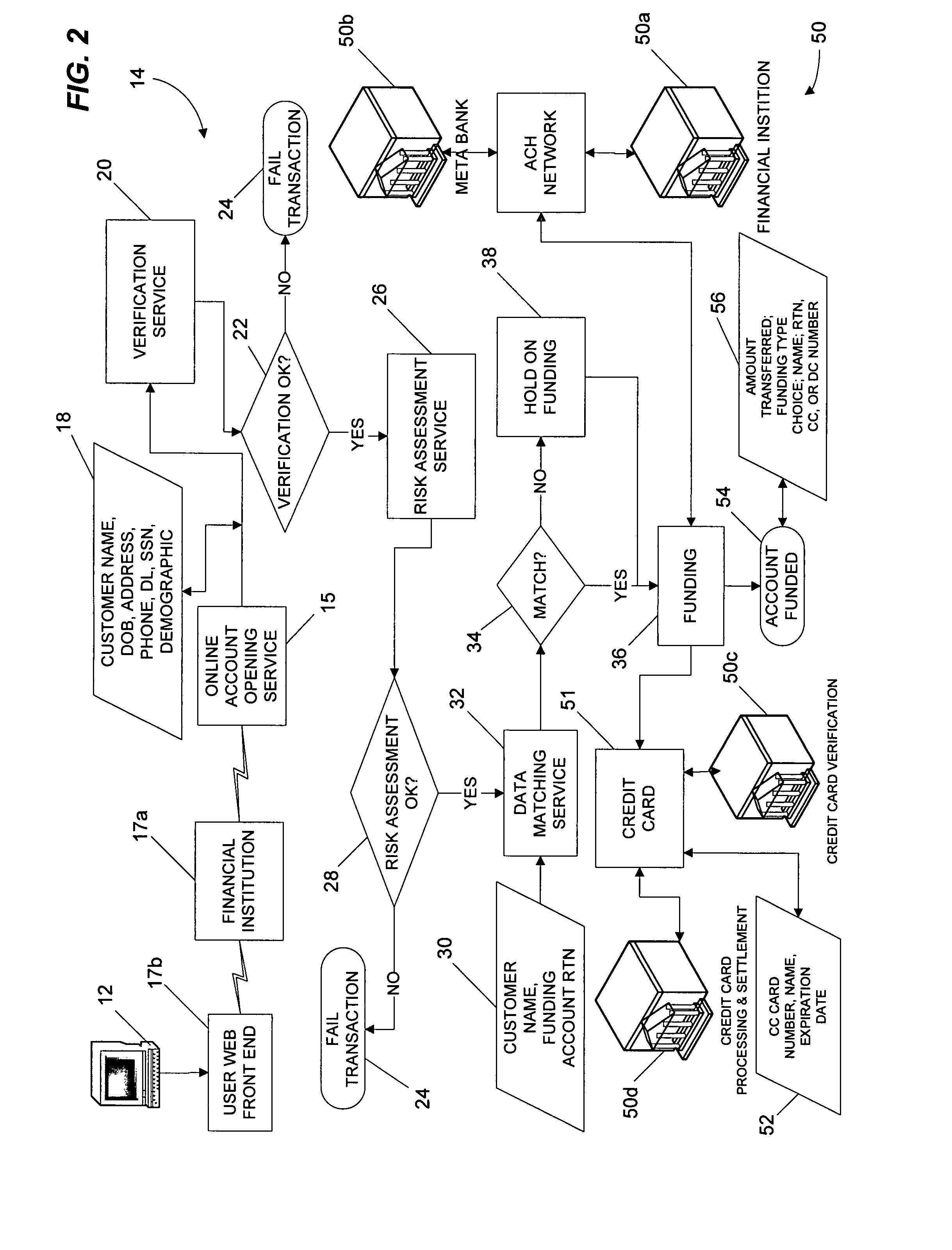

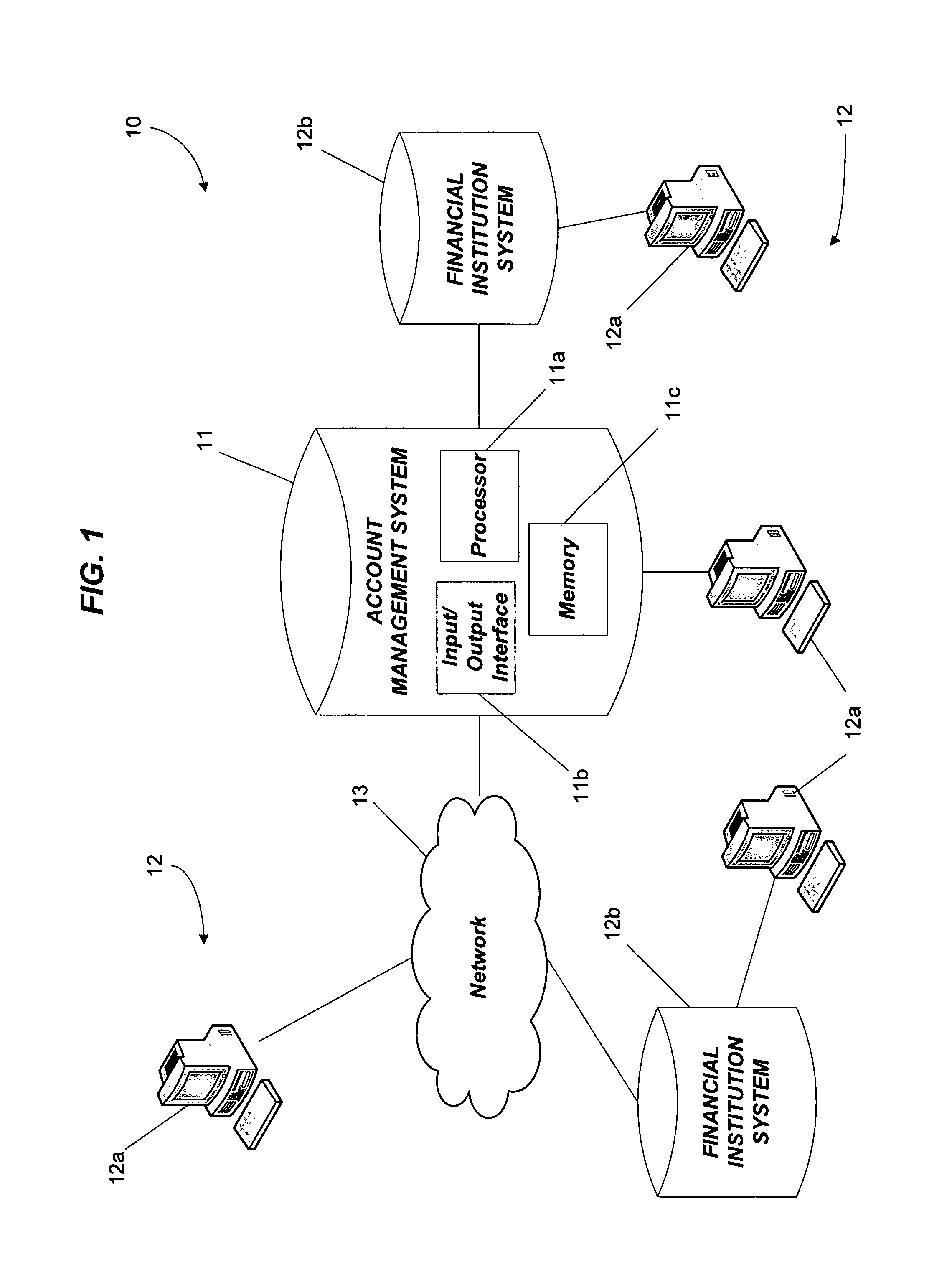

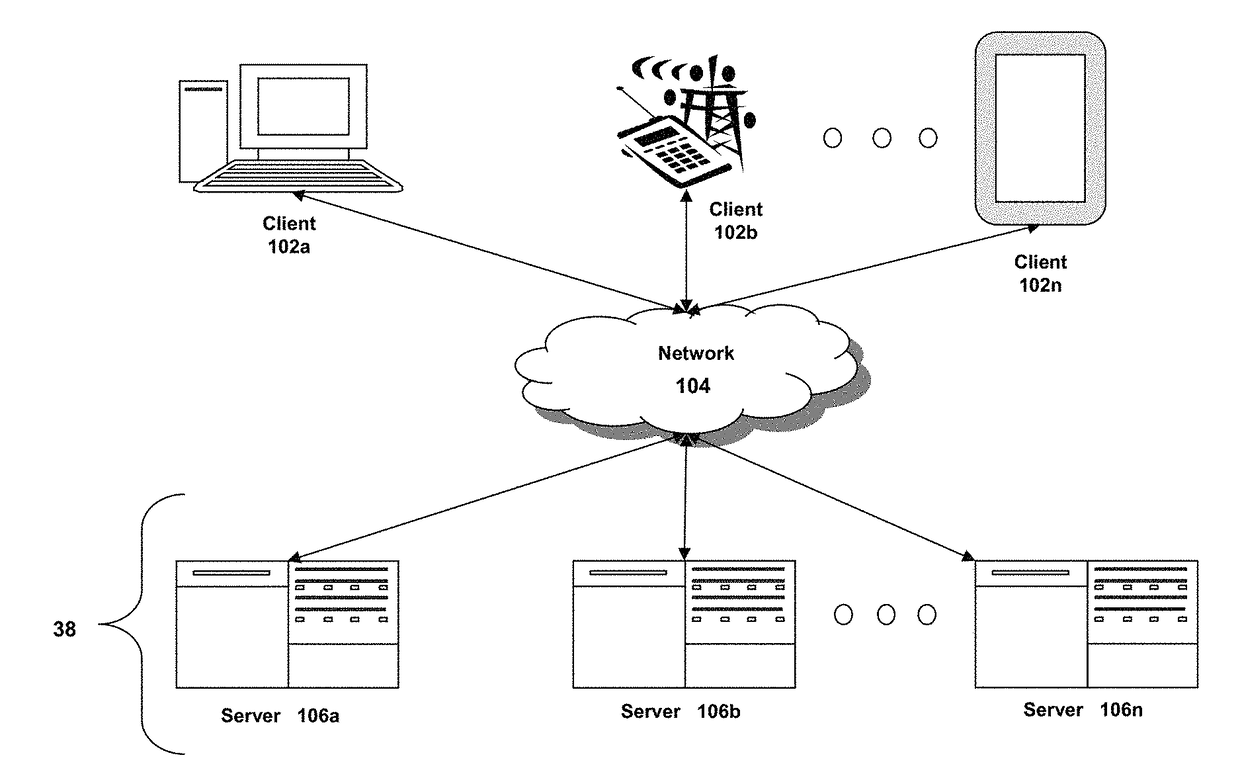

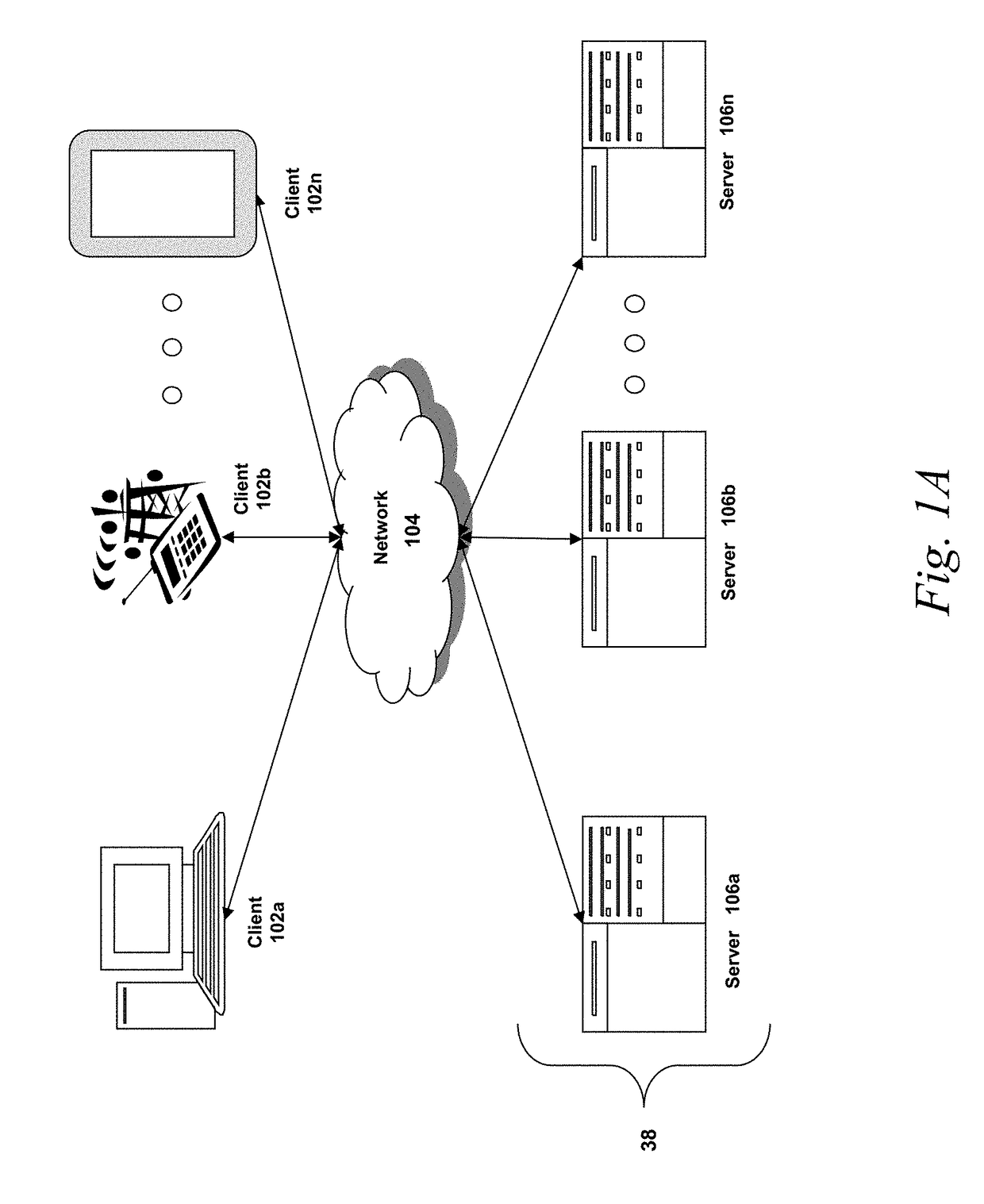

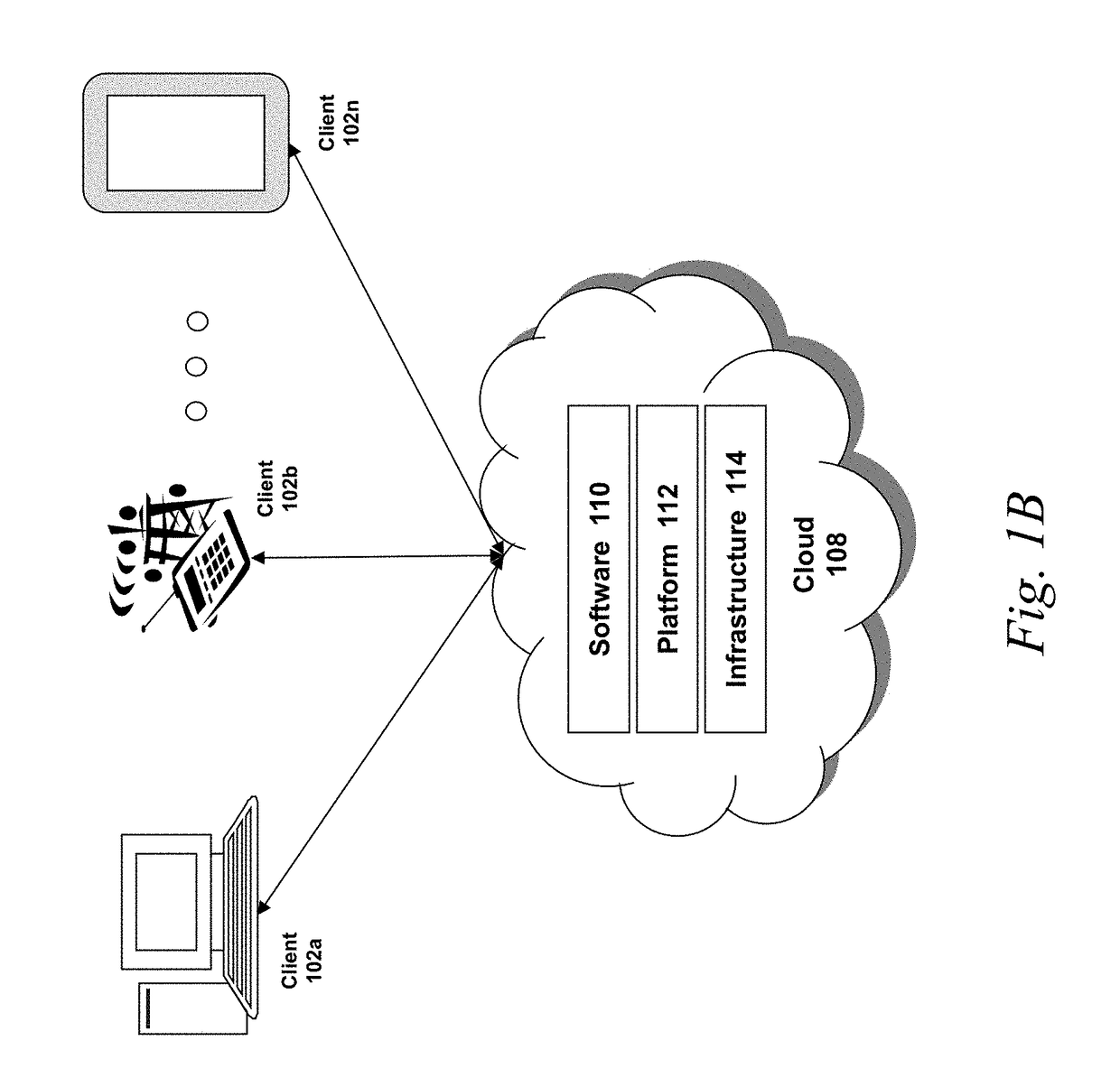

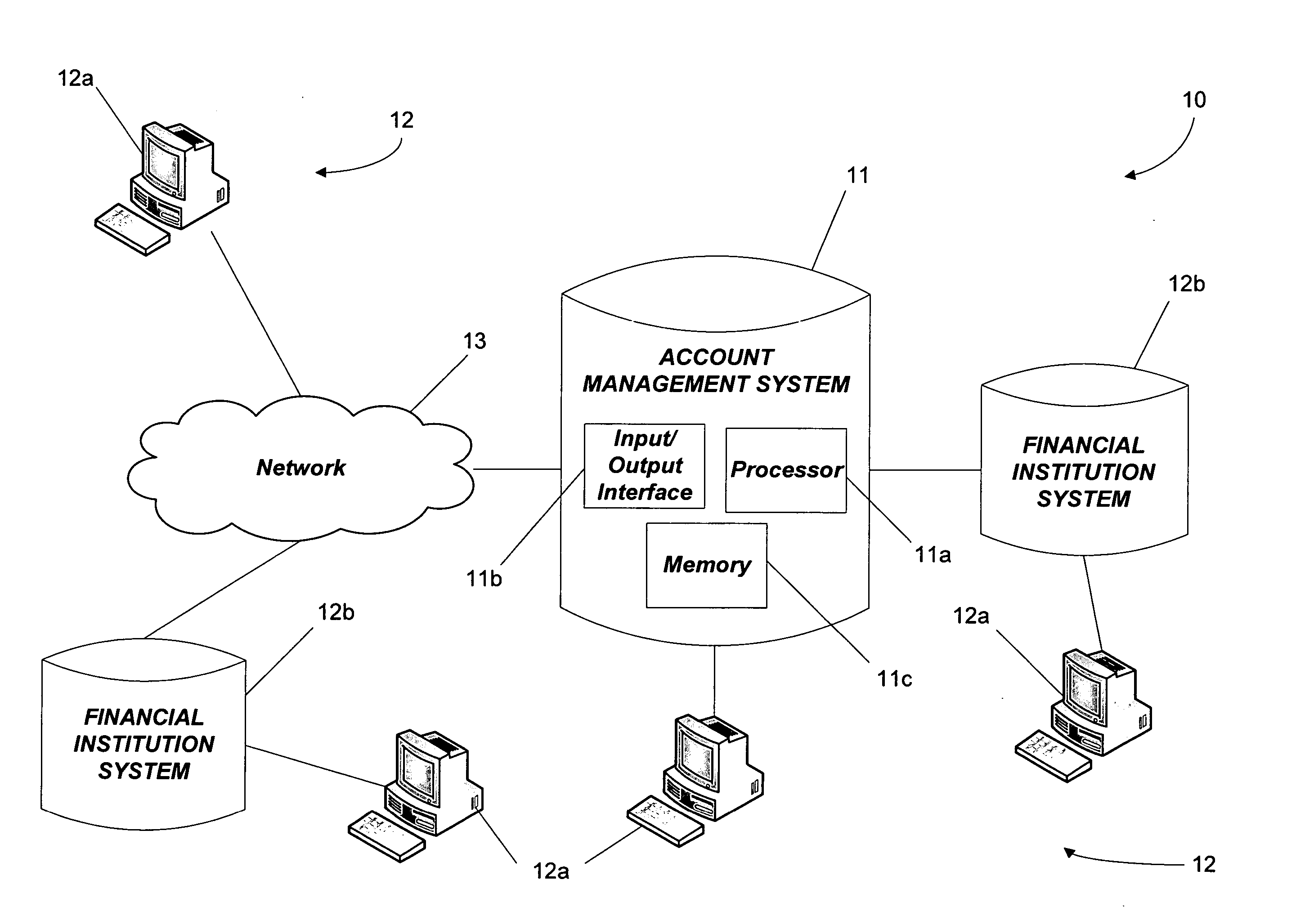

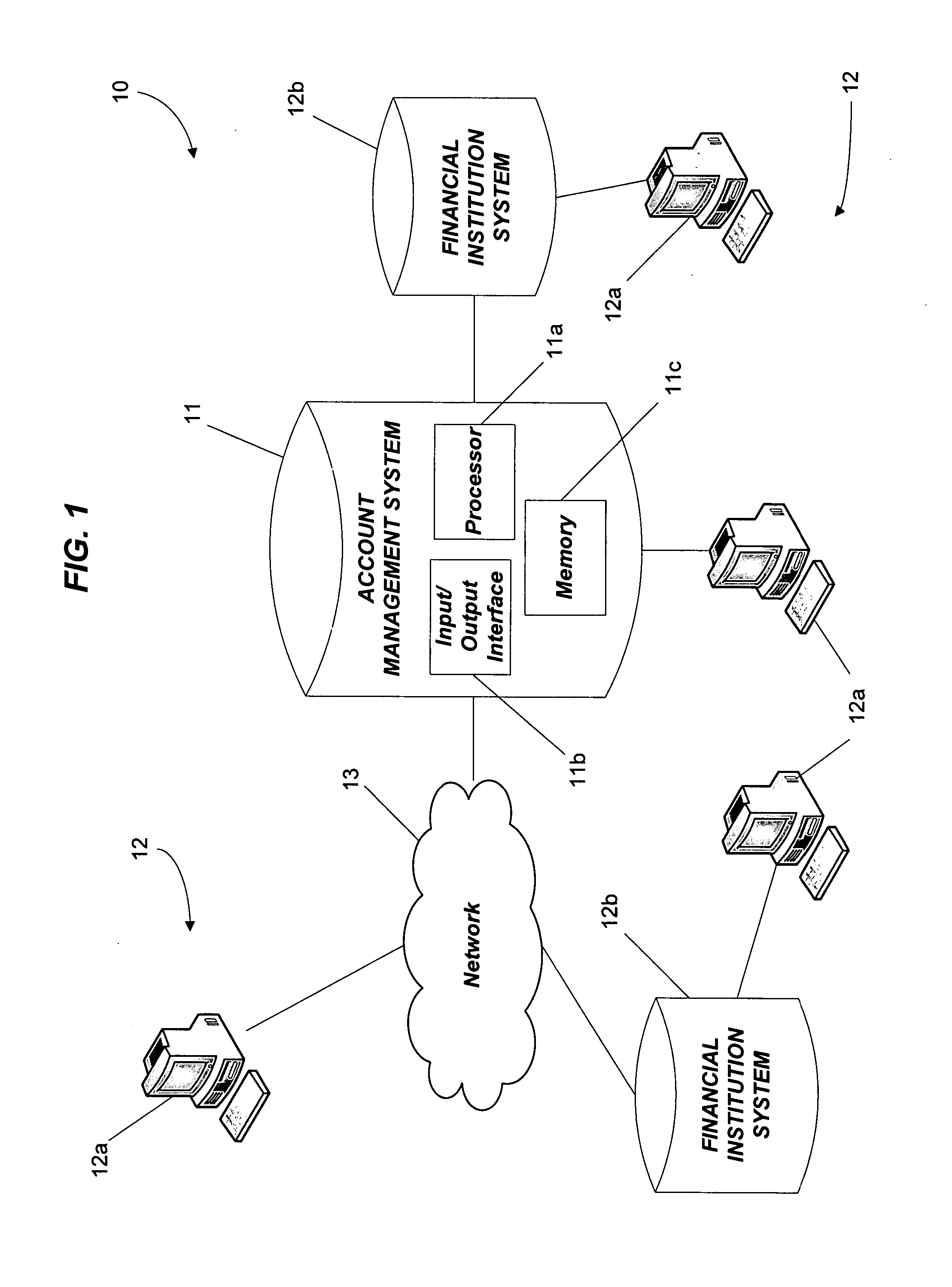

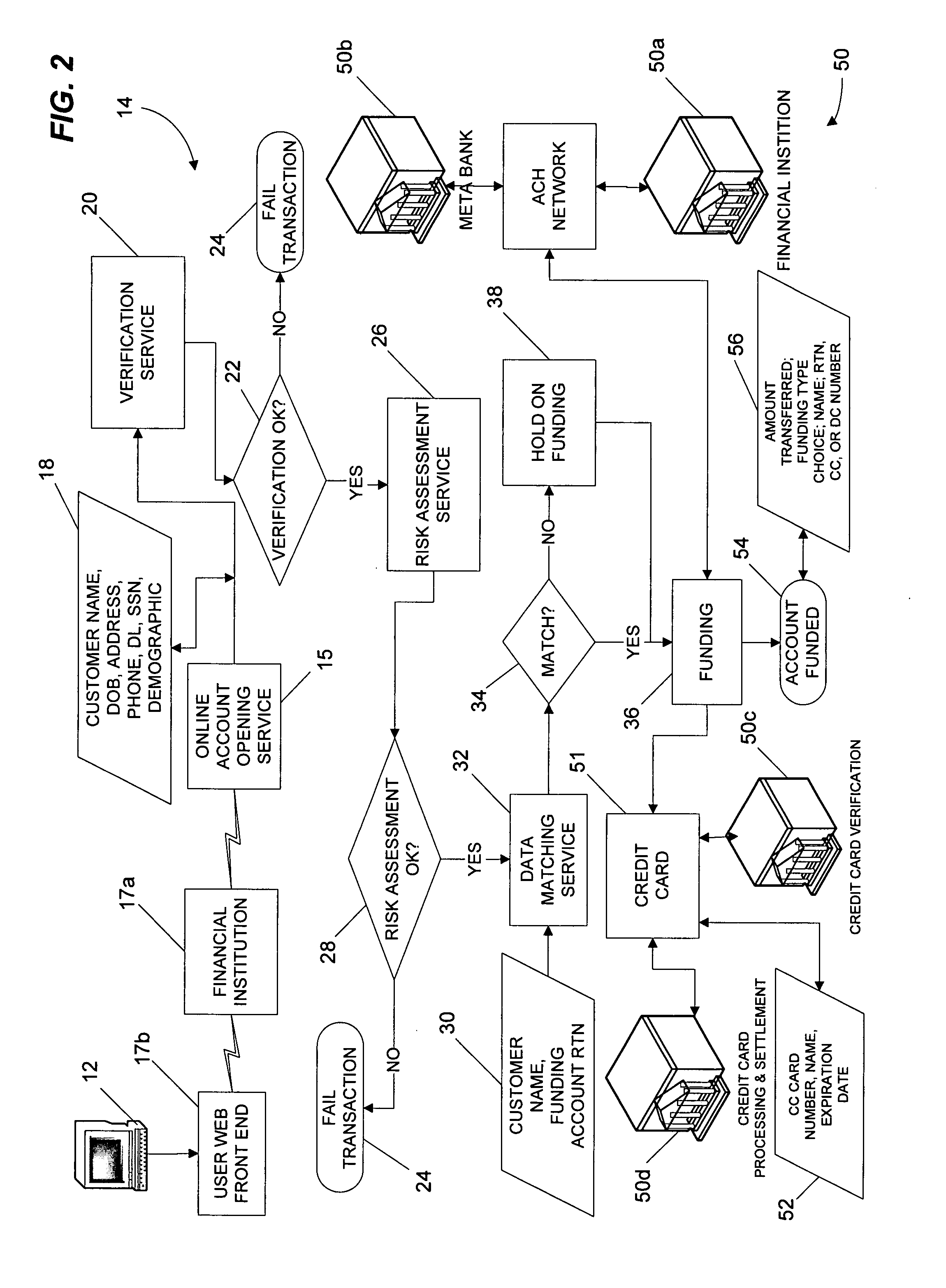

Methods and systems for monitoring an online account opening service. One system can include an account management system that performs an online account opening service and includes a management console application. The online account opening service electronically receives account application information and funding information specifying at least one funding source, processes the account application to assess a risk to a financial institution of opening an account for a customer, processes the funding source information to assess a risk to the financial institution of transferring funds from the at least one funding source to the account, and electronically transfers funds from the at least one funding source to the account based on the risk to the financial institution of opening the account for the customer and the risk to the financial institution of transferring funds from the at least one funding source to the account. The management console application provides substantially real-time status of the online account opening service. The system can also include at least one network, and at least one remote device connected to the account management system via the at least one network. The at least one remote device accesses the management console application to obtain the substantially real-time status of the online account opening service.

Owner:FIDELITY INFORMATION SERVICES LLC

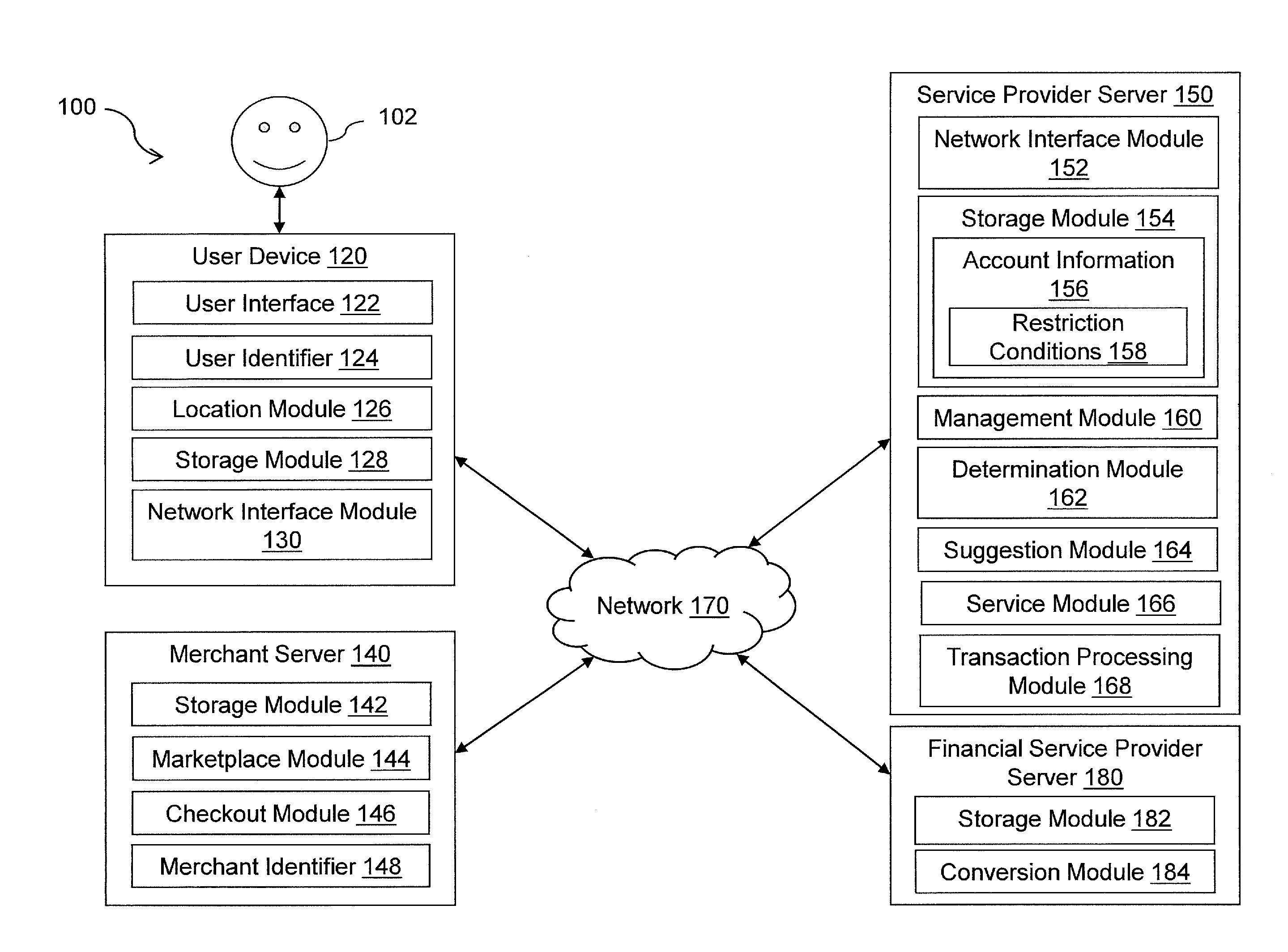

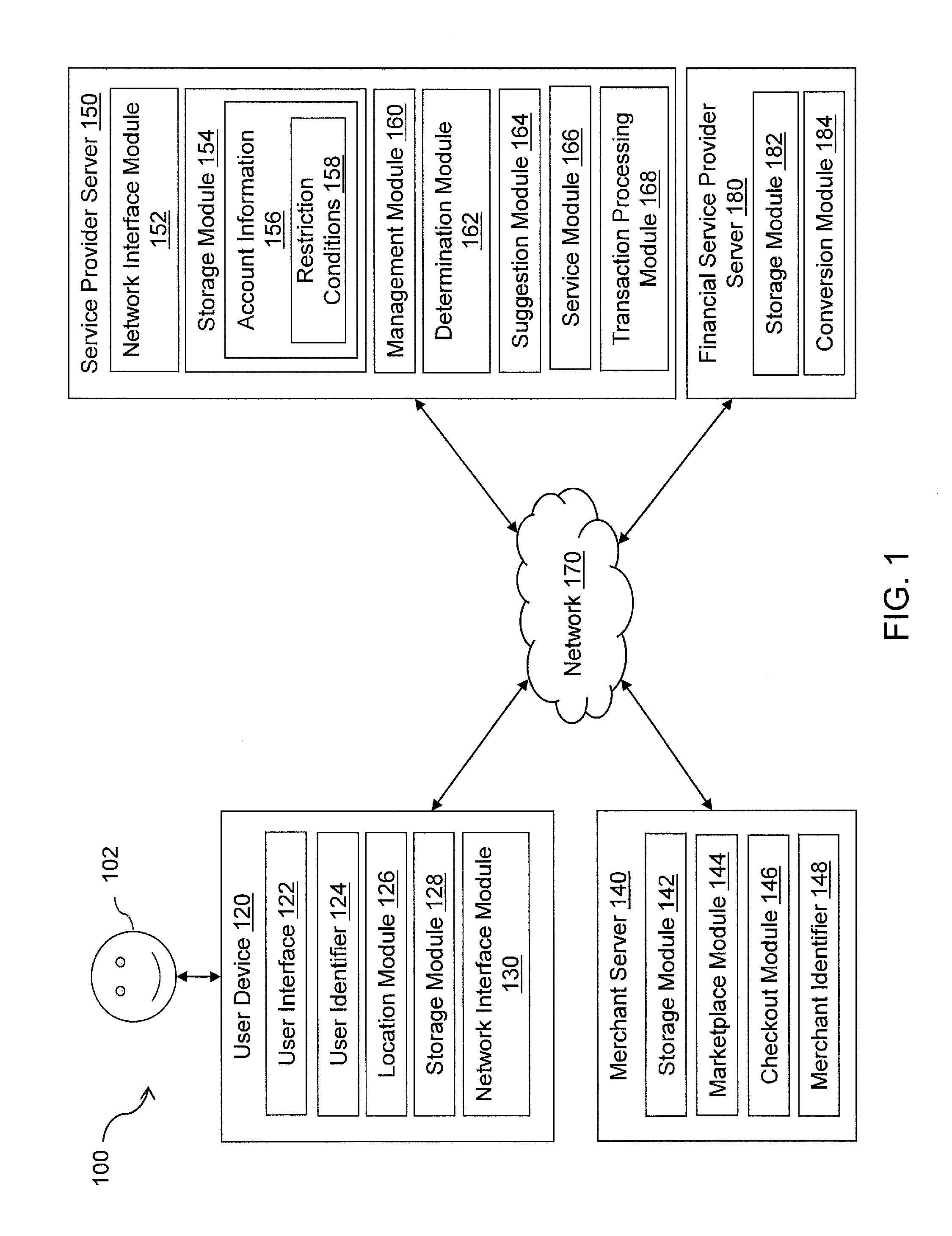

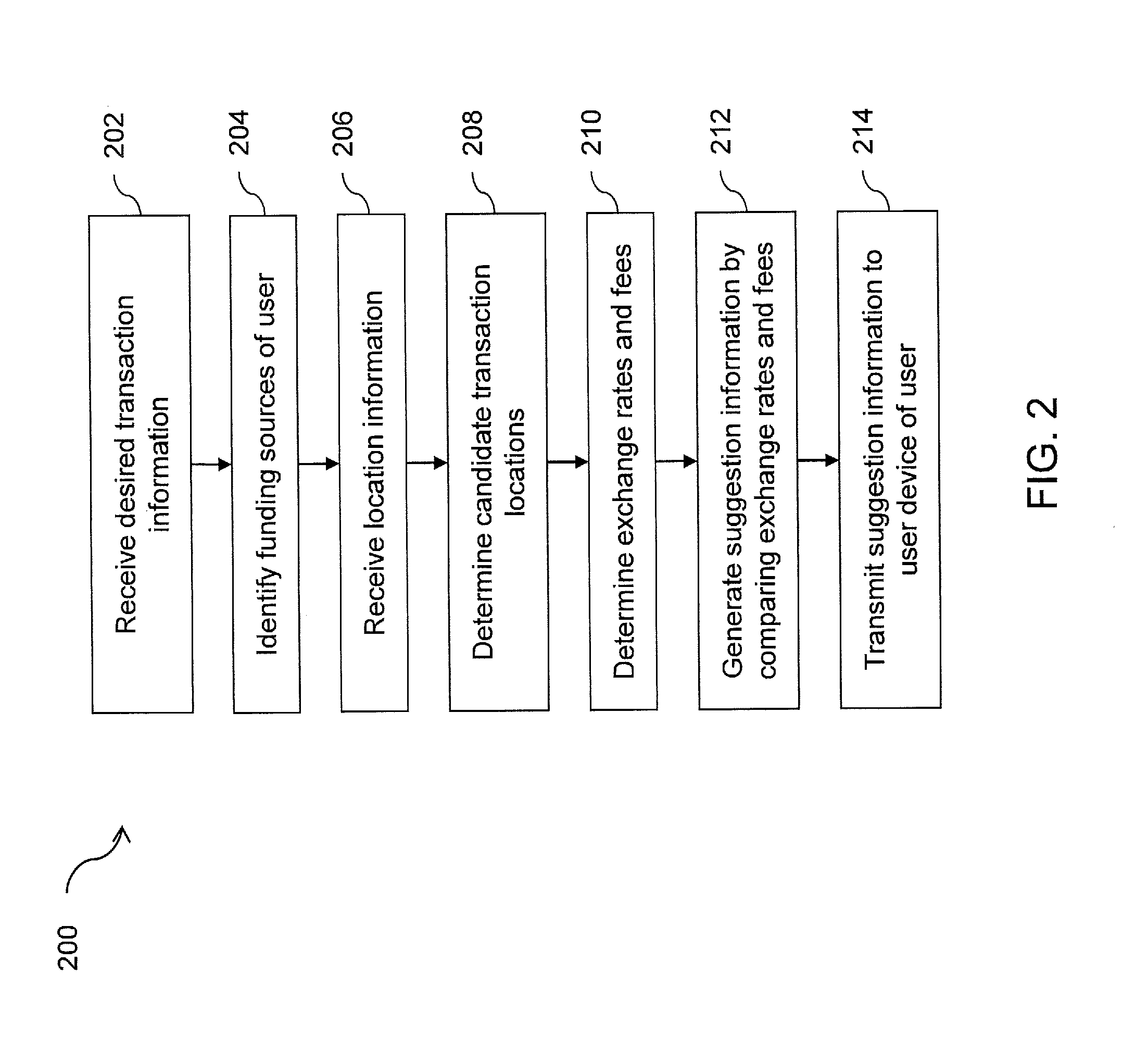

Systems and methods for generating suggestions and enforcing transaction restrictions

A user traveling abroad may decide to make a purchase transaction from a merchant, or exchange cash to foreign currency, or withdraw foreign currency from a funding source of the user. A service provider server may determine exchange rates and transaction fees for different funding sources of the user and / or at different currency exchange locations. The service provider server may further suggest a particular funding source and / or a currency exchange location. The user may conveniently make an informed decision regarding which currency exchange location to go to and which funding source to use. After the trip, the user may have leftover foreign currency. The user may exchange the foreign currency for credit in a restricted account that can be used to make purchases but cannot be cashed out. The credit may be converted to domestic currency and may conveniently be used to make purchases.

Owner:PAYPAL INC

Healthcare card closed loop network

A method comprises the steps of: receiving, at a host computer, a request from a provider for payment for a charge incurred by a purchaser; identifying a plurality of funding sources of the purchaser from which to draw funds for payment of the charge; and causing at least one of the plurality of funding sources to be debited for at least a portion of the purchasing amount of the item based on the payment authorization.

Owner:LIBERTY PEAK VENTURES LLC

Systems and methods for allocating resources via information technology infrastructure

ActiveUS20170178093A1Improve performanceImprove operationFinancePayment architectureApplication programming interfaceFinancial transaction

A system to allocate resources via information technology infrastructure is described. A server includes processors to provide to a plurality of devices, an electronic benefits account transaction application programming interface (“API”) configured to receive transaction requests from a plurality of heterogeneous electronic funding sources. The server can receive a request to initiate a single transaction to fund an electronics benefit account. The server can transmit data in an alert format indicating a denial of the single request responsive to a comparison of a value to one or more threshold limits.

Owner:ALEGEUS TECH LLC

Methods and systems for opening and funding a financial account online

Methods of systems of opening an account with a financial institution. One method can include electronically receiving account application information over at least one network. The account application information includes personal information associated with a customer requesting to open an account. The method also includes processing the account application information to assess a first risk to the financial institution of opening the account for the customer and electronically receiving funding source information. The funding source information specifies at least one of an existing credit card account and an existing debit card account. In addition, the method includes processing the funding source information to assess a second risk to the financial institution of transferring funds from at least one of the existing credit card account and the existing debit card account. The method further includes electronically transferring funds to the account from at least one of the existing credit card account and the existing debit card account based on at least one of the first risk and the second risk.

Owner:FIDELITY INFORMATION SERVICES LLC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com