Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

64 results about "EFTS" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

EFTS is an acronym for Equivalent Full Time Student. It is a definition used to measure student numbers at New Zealand educational institutions. One EFTS will be made up of more than one part-time students (e.g. two half time students).

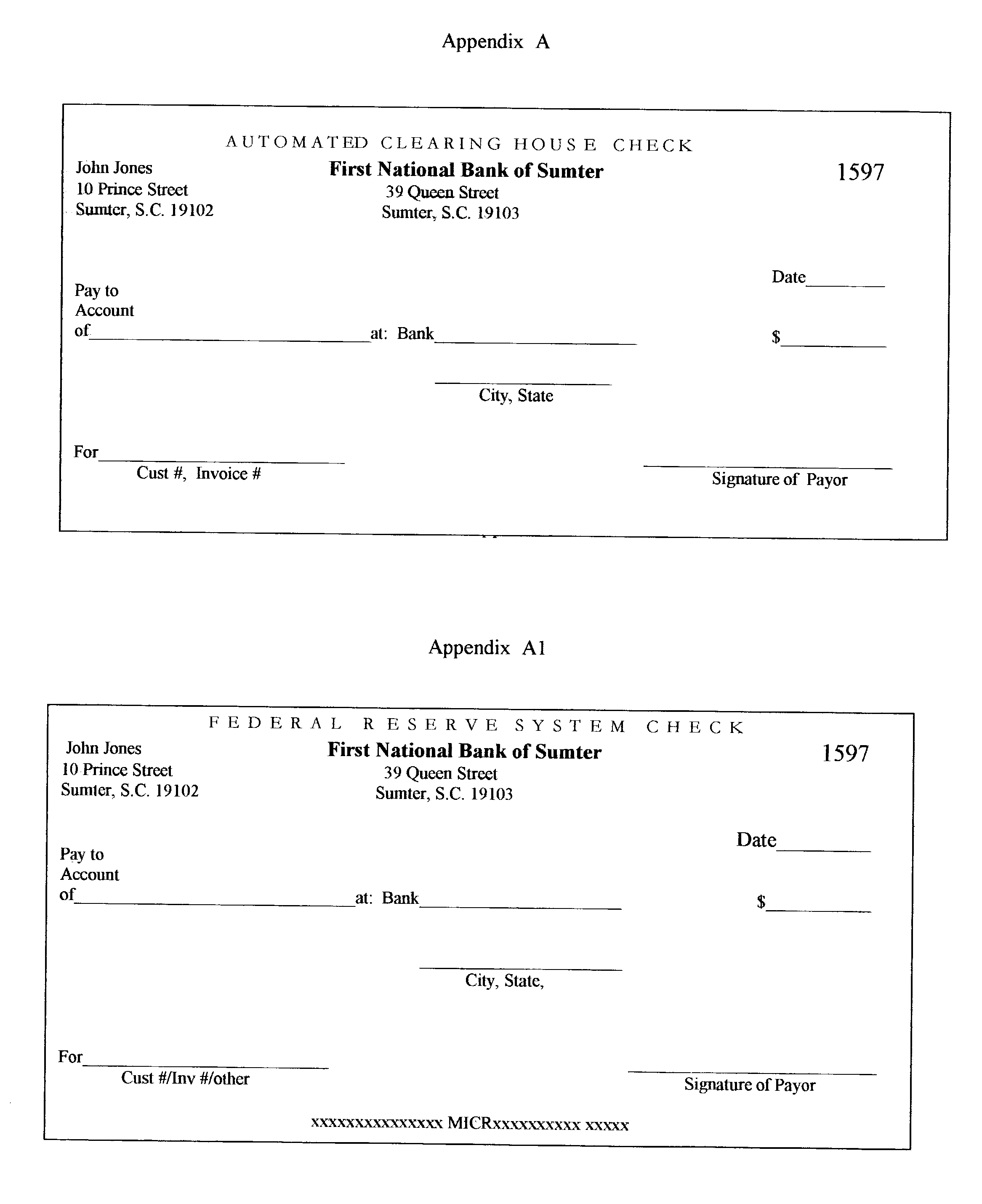

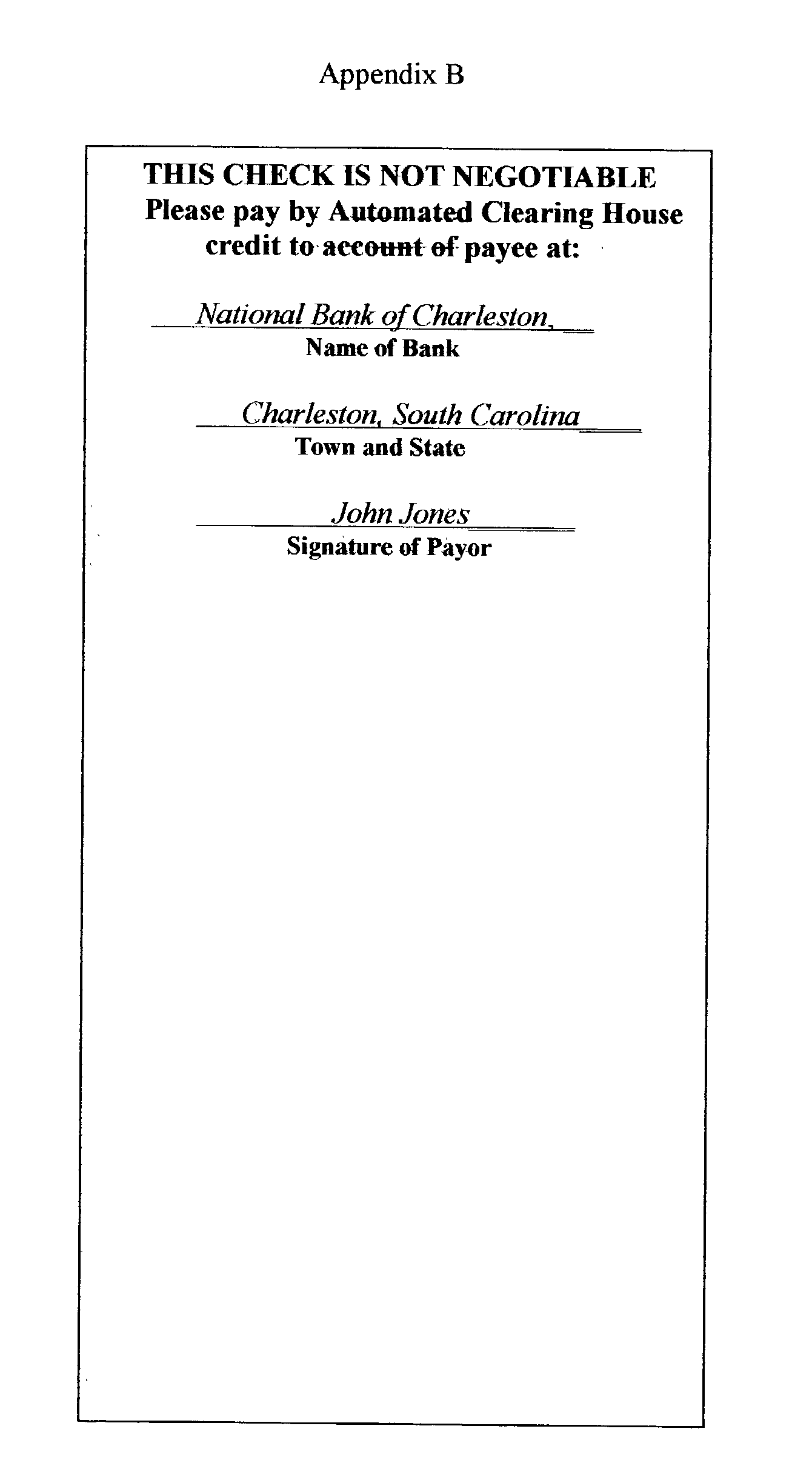

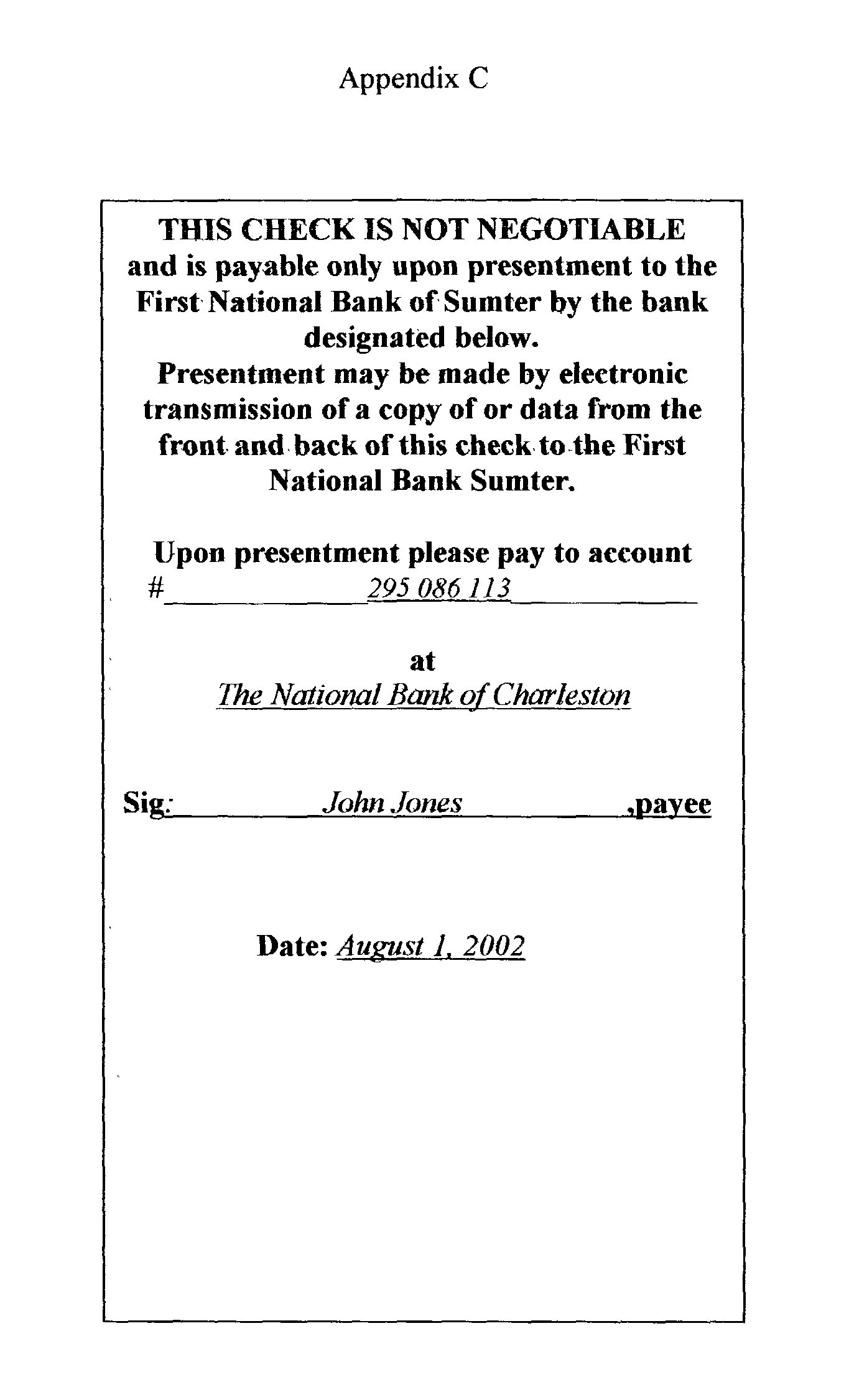

Method of making money payments

The system disclosed is for making payments using a new type of bank check combined with electronic funds transfer (EFT) facilities The new type check is not a negotiable instrument and is intended for delivery to the payor's bank rather than to the payee. The check instructs the payor's bank to make a payment by EFT from the payor's bank account directly to the bank account of the payee at the payee's bank, normally via the Federal Reserve's Automated Clearing House (ACH) facility. The system includes means for making a true, but inoperative, copy of each check at the time the check is written. Other embodiments of the invention are special checks, which look like conventional checks, but on their reverse sides display printed matter stating that they are non-negotiable and are payable only pursuant to special procedures.

Owner:ALLAN FREDERICK ALEY

System and method for electronic deposit of third-party checks by non-commercial banking customers from remote locations

InactiveUS20050267843A1Level of independenceFinanceCo-operative working arrangementsThird partyCheque

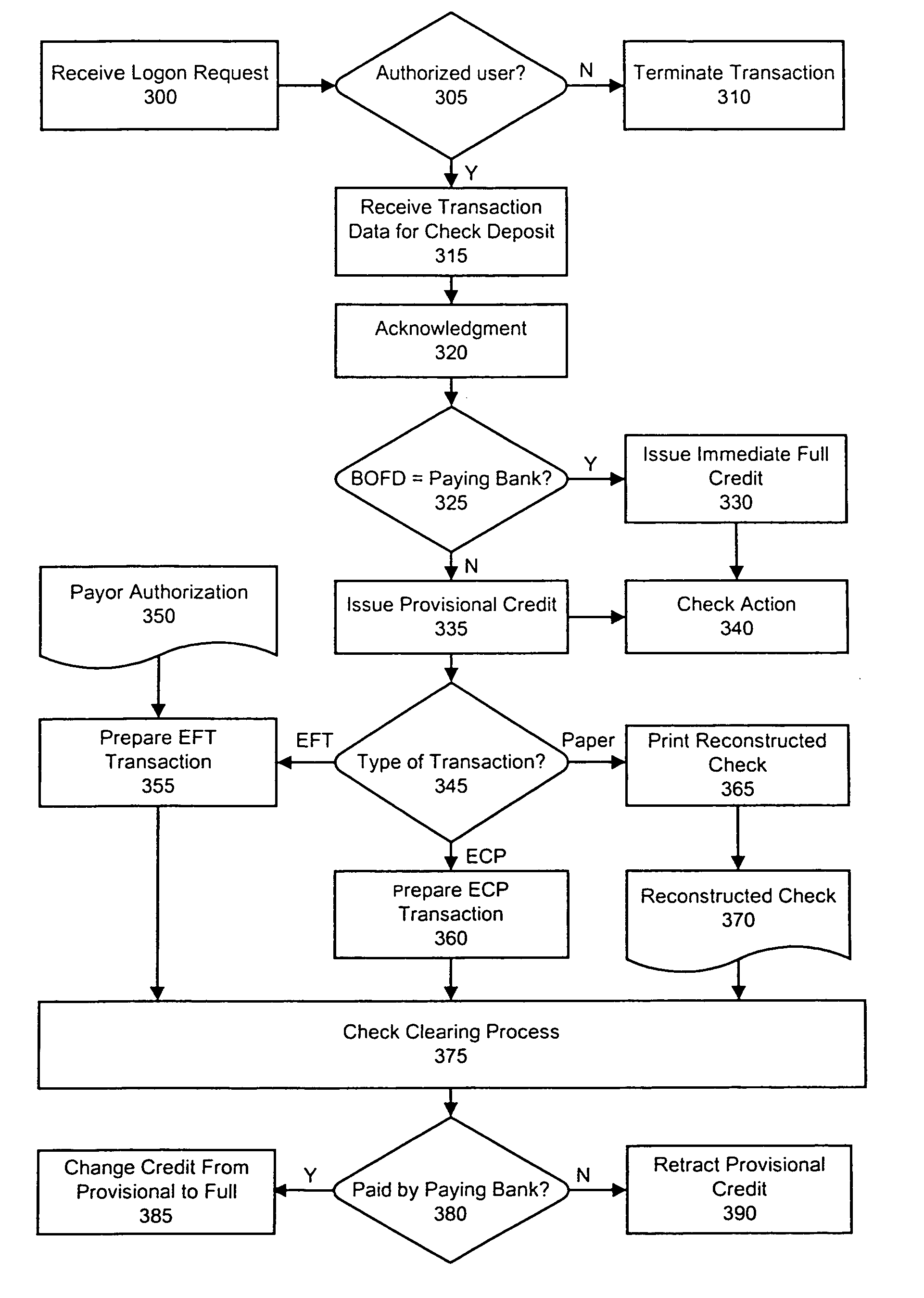

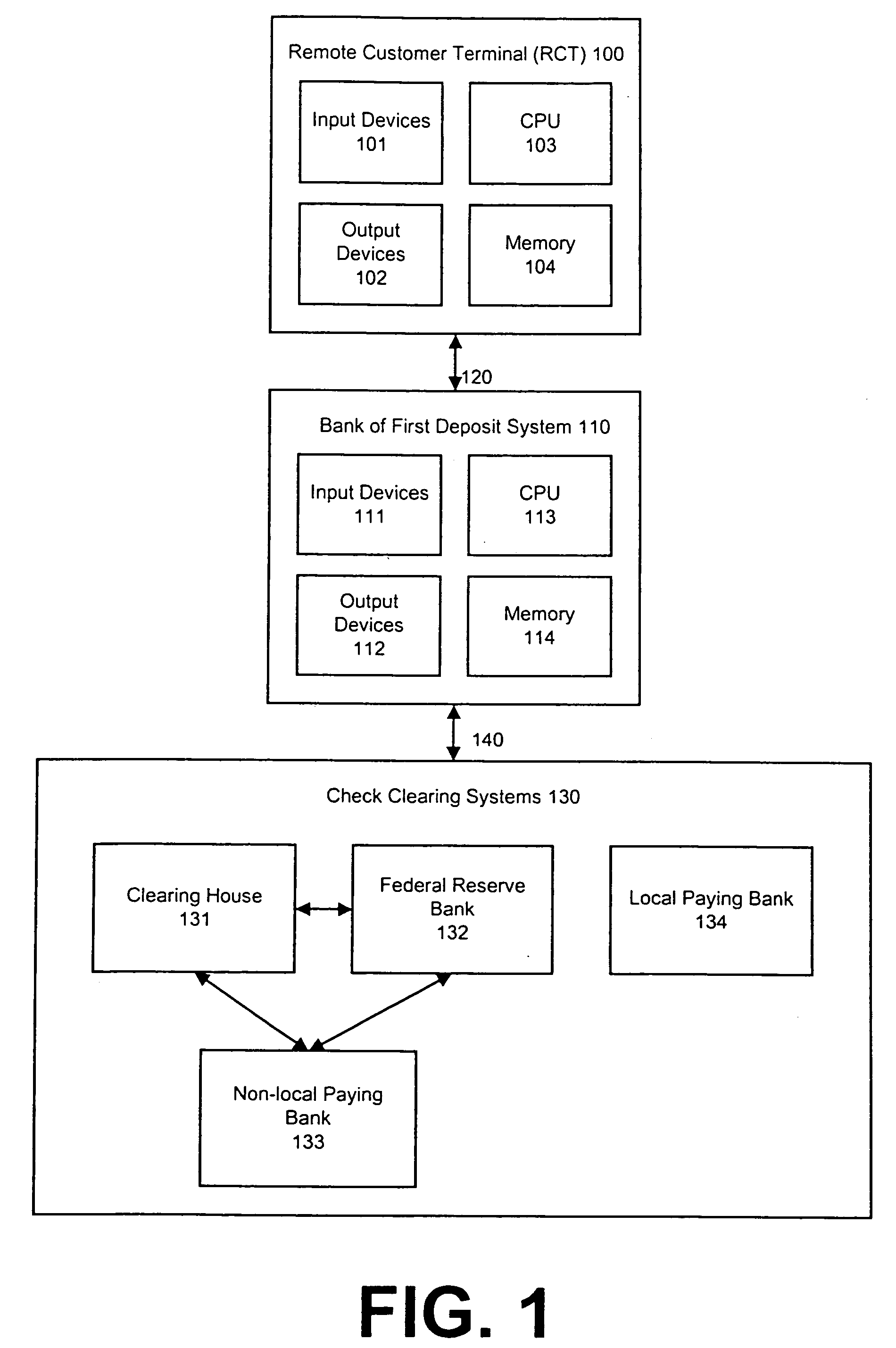

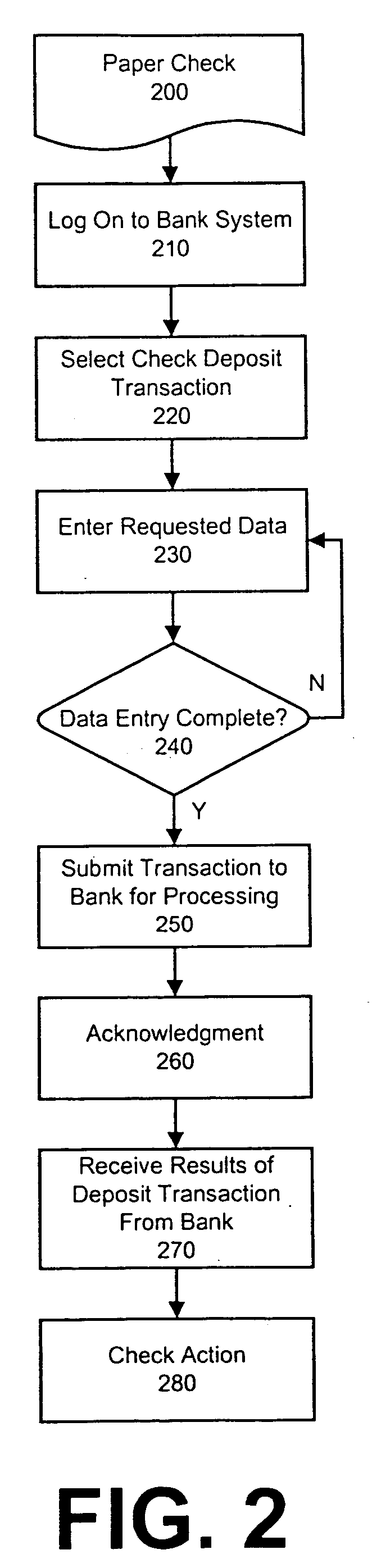

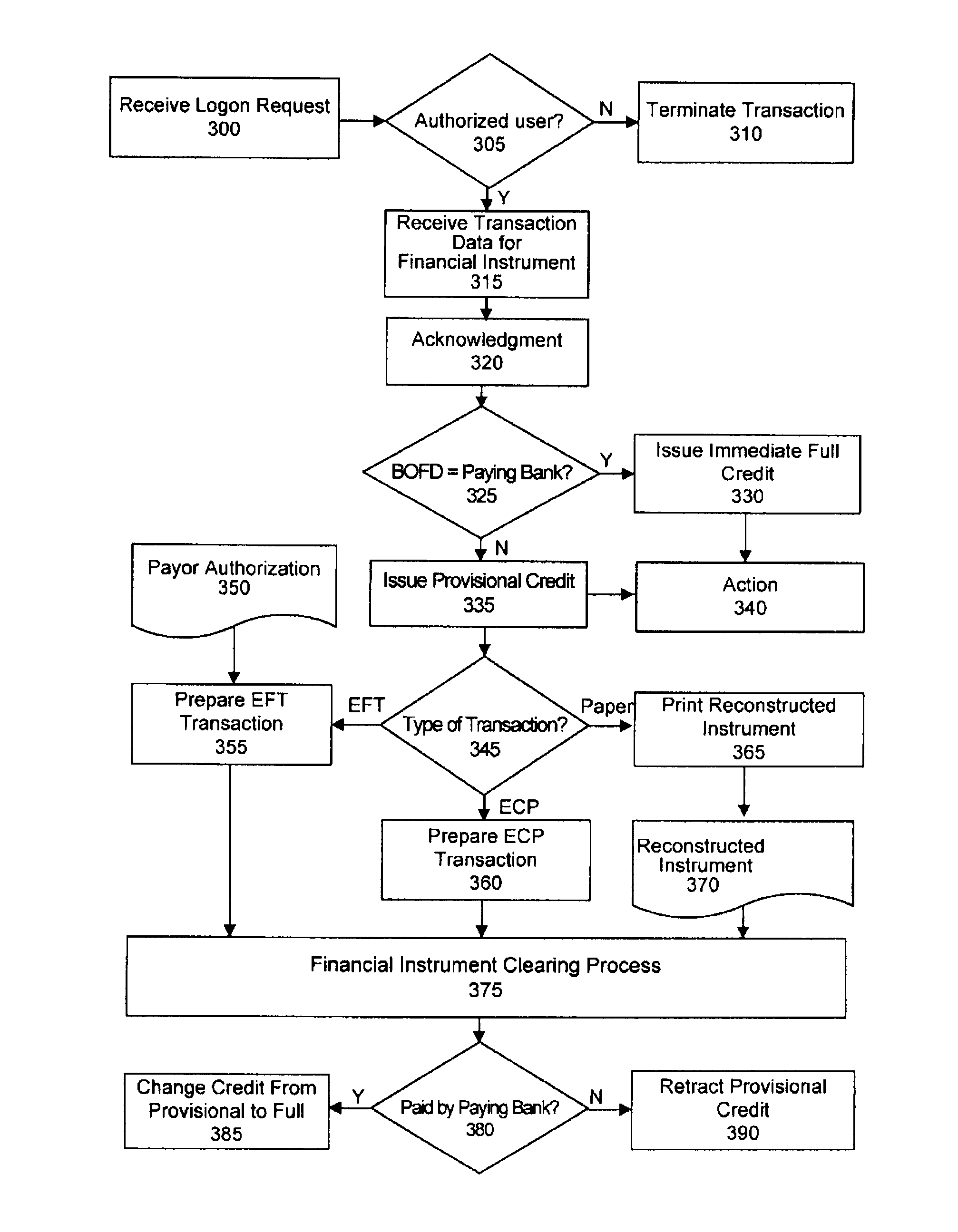

A system and method for initiating a deposit transaction, where the depositor is a non-commercial banking customer located at a remote location, and where the item to be deposited is a paper check from a third party, payable to the depositor. The enabling system features a Remote Customer Terminal (RCT) with certain input devices, connected to a bank system. The image and / or other data sent from the RCT to the Bank of First Deposit (BOFD) may be processed by conversion to Electronic Funds Transfer (EFT), via Electronic Check Presentment (ECP), or via check reconstruction. The new system and method provide convenience and improved transaction processing speed compared to other transactions that begin with a third party check.

Owner:BANK ONE CORPORATION

Systems for Enhancing Funding of Gaming

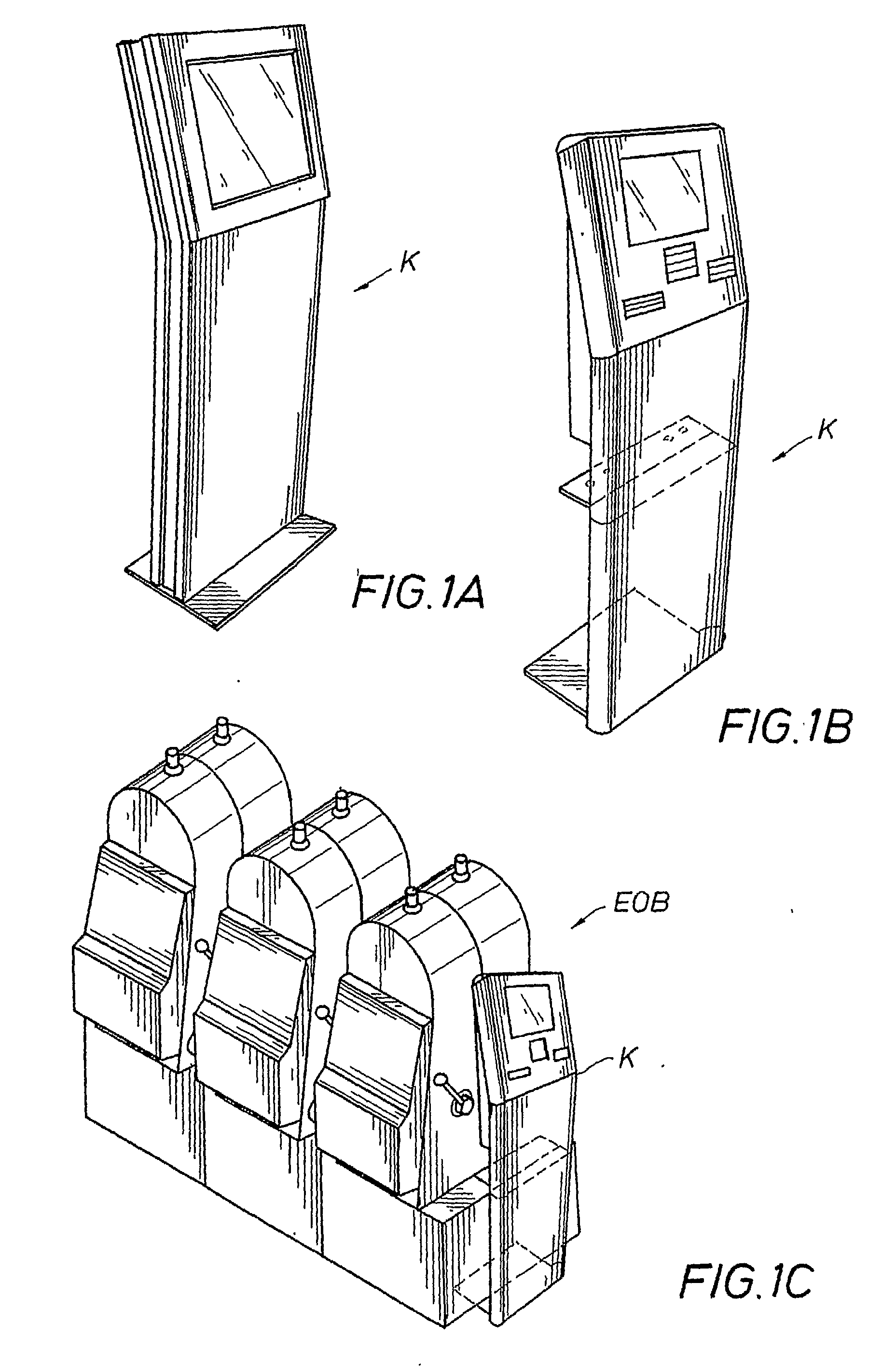

ActiveUS20100222132A1Targeted optimizationMaximize versatilityPayment architectureApparatus for meter-controlled dispensingProximateVoucher

Apparatus and method for facilitating the funding of gaming and preferably the purchase of gaming vouchers (slot vouchers) with commercial bank cards and / or with casino and / or new credit accounts (private label and / or affiliate / Networking permanent or temporary) and / or the prompting of opening of a new credit account, including an automated kiosk located on a gaming floor proximate to gaming machines but separate from particular gaming machines, and including method and apparatus for the purchase and redemption of vouchers at a gaming table, including reading and printing equipment in communication with a voucher host; also including a prompt to open new a gaming oriented line of credit, associated with a refusal of an EFT transaction, preferably a credit / debit card cash advance request, and including a preferred gaming oriented credit card account and card (private label and / or affiliate / Networking permanent or temporary) (including a patron selection coded card) having cash advance limits commensurate with credit limits for gaming oriented transactions and wherein a cash advance can be secured within an hour after the opening and approval of the account, the approval of the account preferably based on EFT gaming transaction history.

Owner:EVERI PAYMENTS

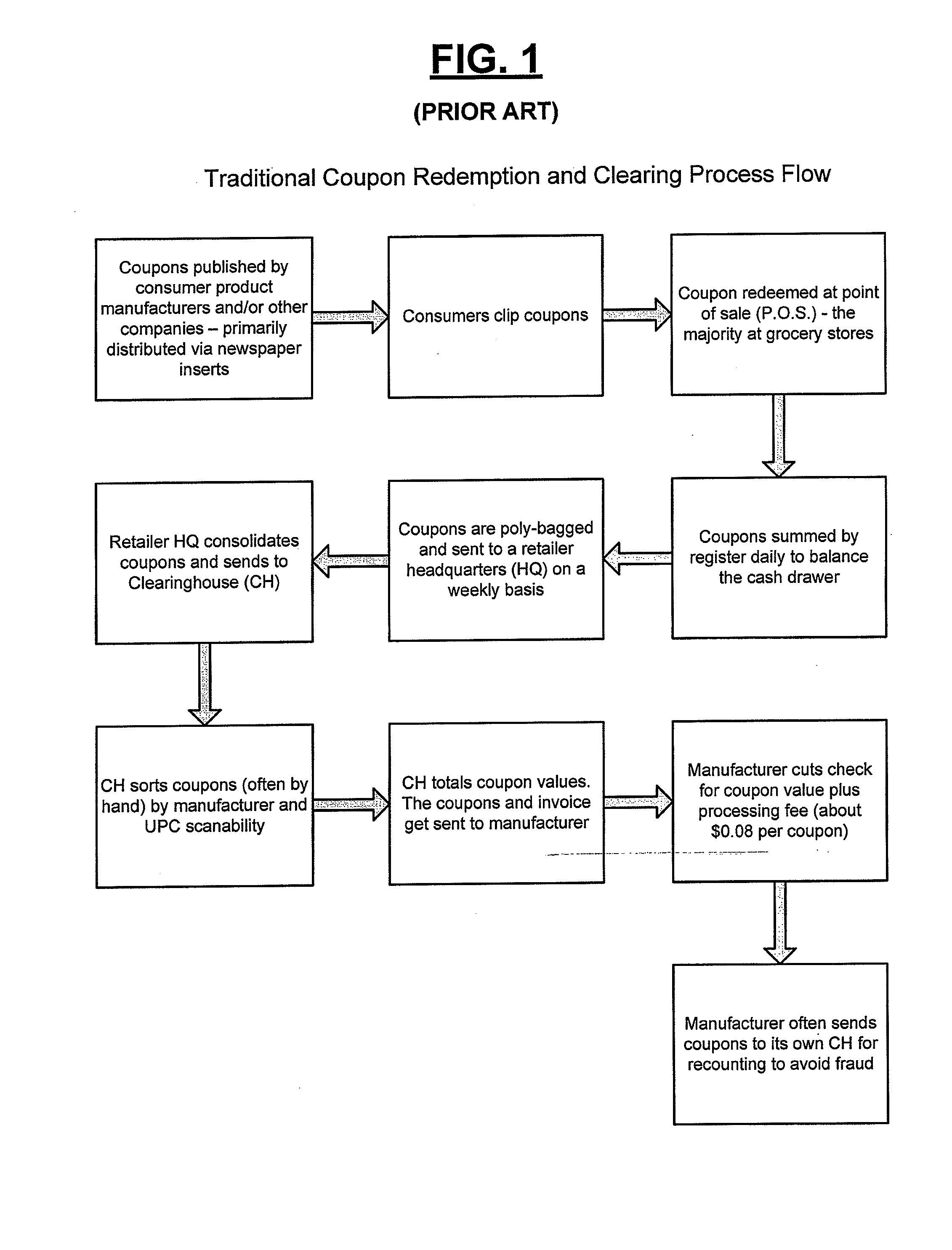

E-Coupon System and Method

InactiveUS20070288313A1Facilitating promotional communicationFacilitate communicationPoint-of-sale network systemsMarketingEFTSDebit card

A method wherein a consumer registers for an electronic coupon (e-coupon) program and receives an e-coupon card programmed with consumer and corresponding e-coupon account identification information. The consumer selects available coupons from a website which are then loaded into the e-coupon account. Consumer package goods manufacturers (CPGs) are charged the downloaded value of the coupon plus a fee. The consumer may use the e-coupon card at any retailer that has electronic funds transfer (EFT) capabilities, such as credit / debit card acceptance. At a retailer's point of sale (POS) terminal, the consumer swipes the card and the cost of items having an e-coupon is adjusted by the corresponding e-coupon value and deducted from the consumer's final amount due. The CPG is also charged a redemption fee and the retailer is charged an interchange fee. Expired coupons are automatically removed from the account and their value refunded to the CPGs. Reports on redeemed coupons and redeemer profiles can be generated and provided to the CPGs or retailers.

Owner:FIDELITY INFORMATION SERVICES LLC

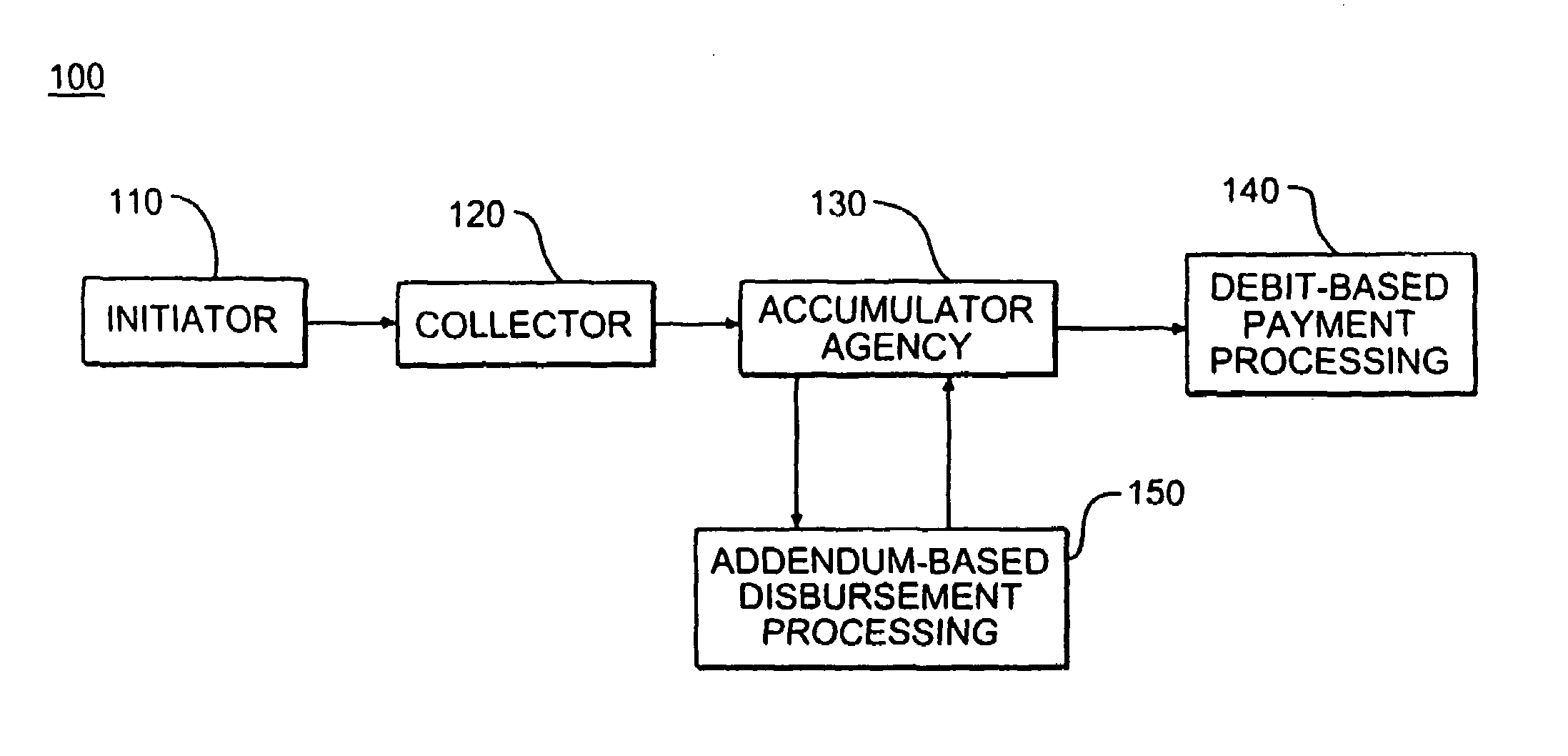

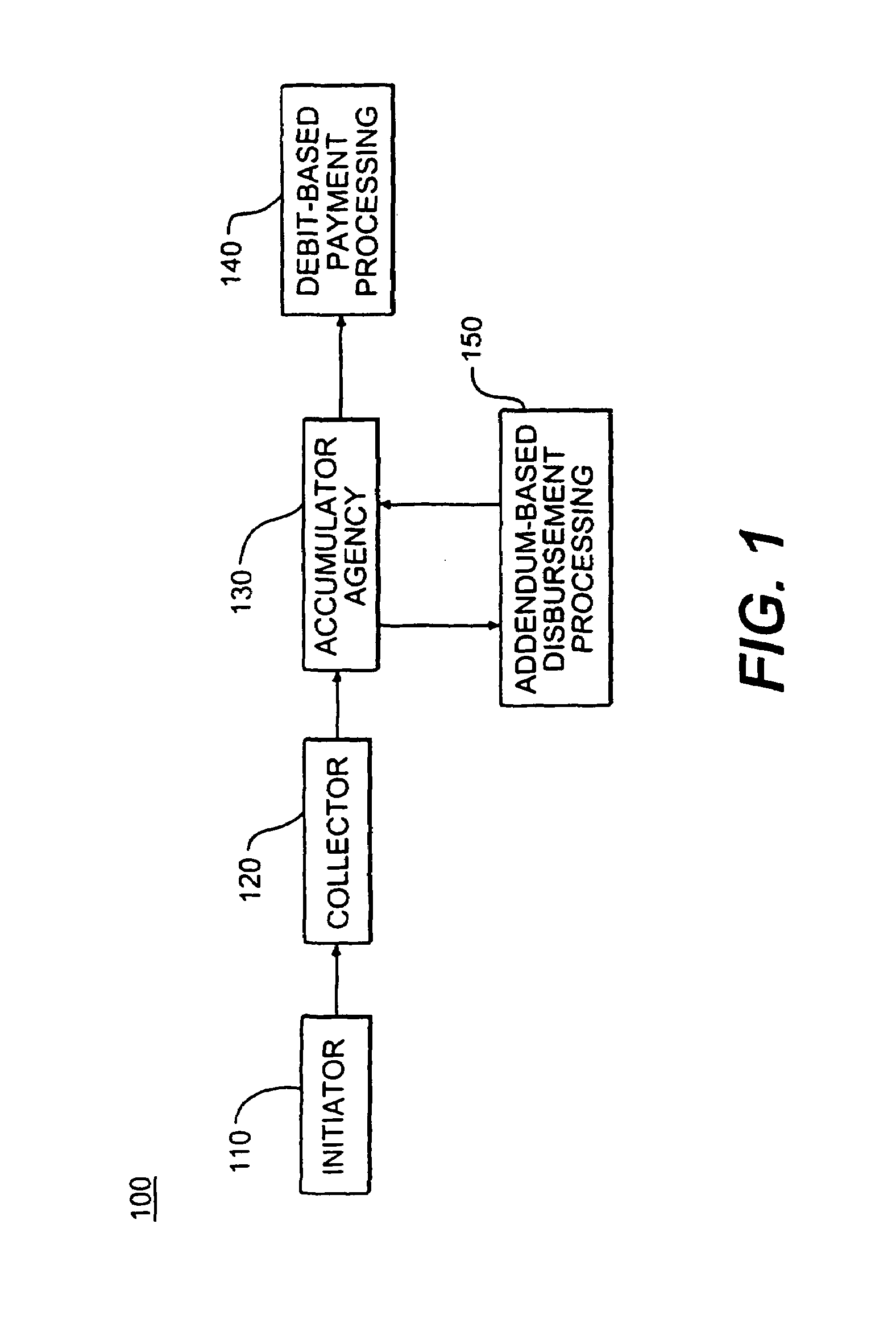

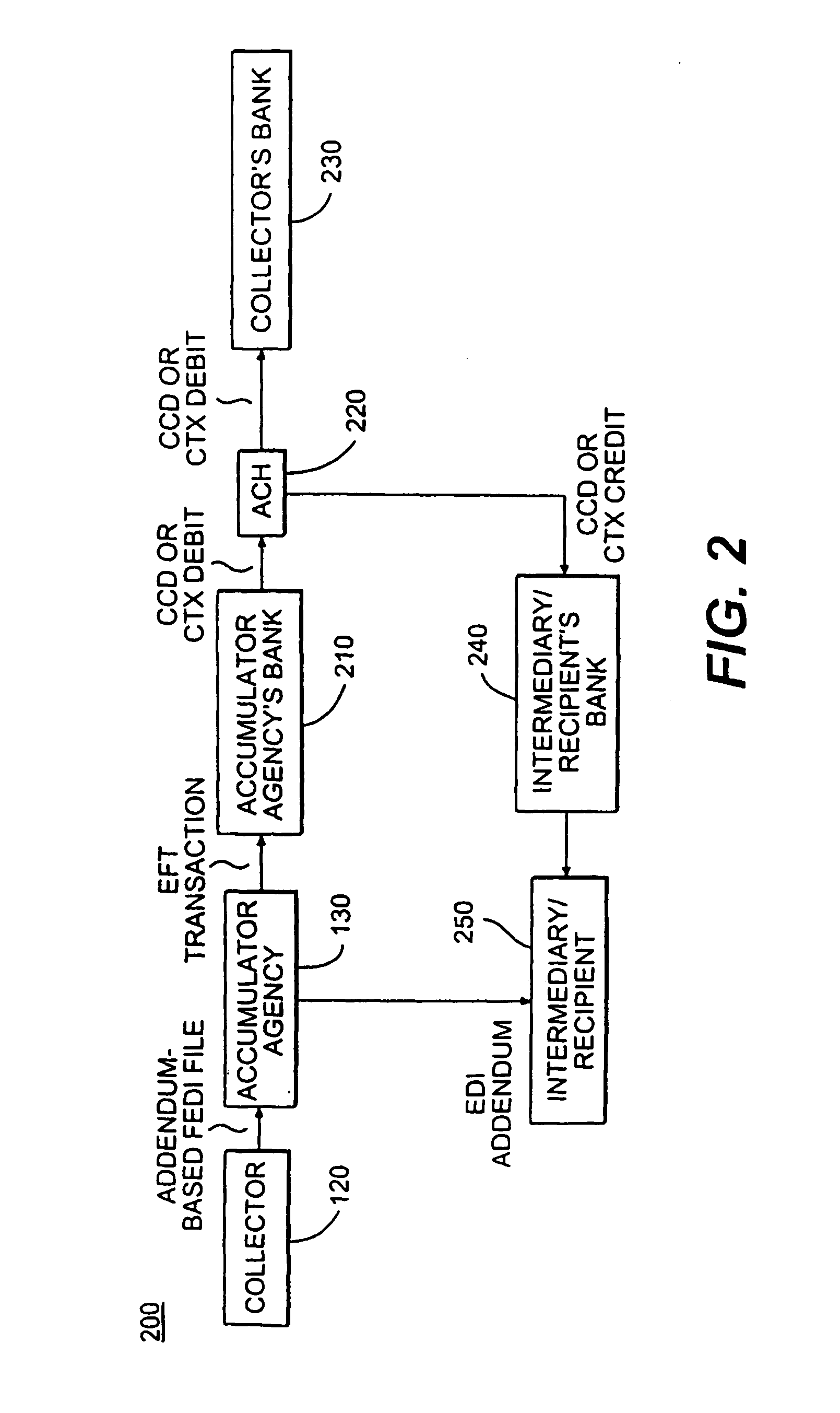

Method and apparatus for payment processing using debit-based electronic funds transfer and disbursement processing using addendum-based electronic data interchange

InactiveUS7225155B1Easy to processFinanceDigital data processing detailsEFTSElectronic funds transfer

This disclosure describes a payment and disbursement system, wherein an initiator authorizes a payment and disbursement to a collector and the collector processes the payment and disbursement through an accumulator agency. The accumulator agency processes the payment as a debit-based transaction and processes the disbursement as an addendum-based transaction. The processing of a debit-based transaction generally occurs by electronic funds transfer (EFT) or by financial electronic data interchange (FEDI). The processing of an addendum-based transaction generally occurs by electronic data interchange (EDI).

Owner:ACS STATE & LOCAL SOLUTIONS

Apparatus and Method for Preventing False Touches in Touch Screen Systems

ActiveUS20140098032A1Preventing false finger touchPreventing false finger touchesInput/output processes for data processingTouchscreenComputer science

A method comprises during a frame period finding a first EFT noise influenced sensor of a touch screen panel, determining whether the first EFT noise influenced sensor is located at a last transmitting / driving line of the touch screen panel, designating the frame period as a noise influenced frame period using an absolute value threshold if the first EFT noise influenced sensor is not located at the last transmitting / driving line and designating the frame period as the noise influenced frame period using a percentage threshold if the first EFT noise influenced sensor is located at the last transmitting / driving line.

Owner:STMICROELECTRONICS ASIA PACIFIC PTE

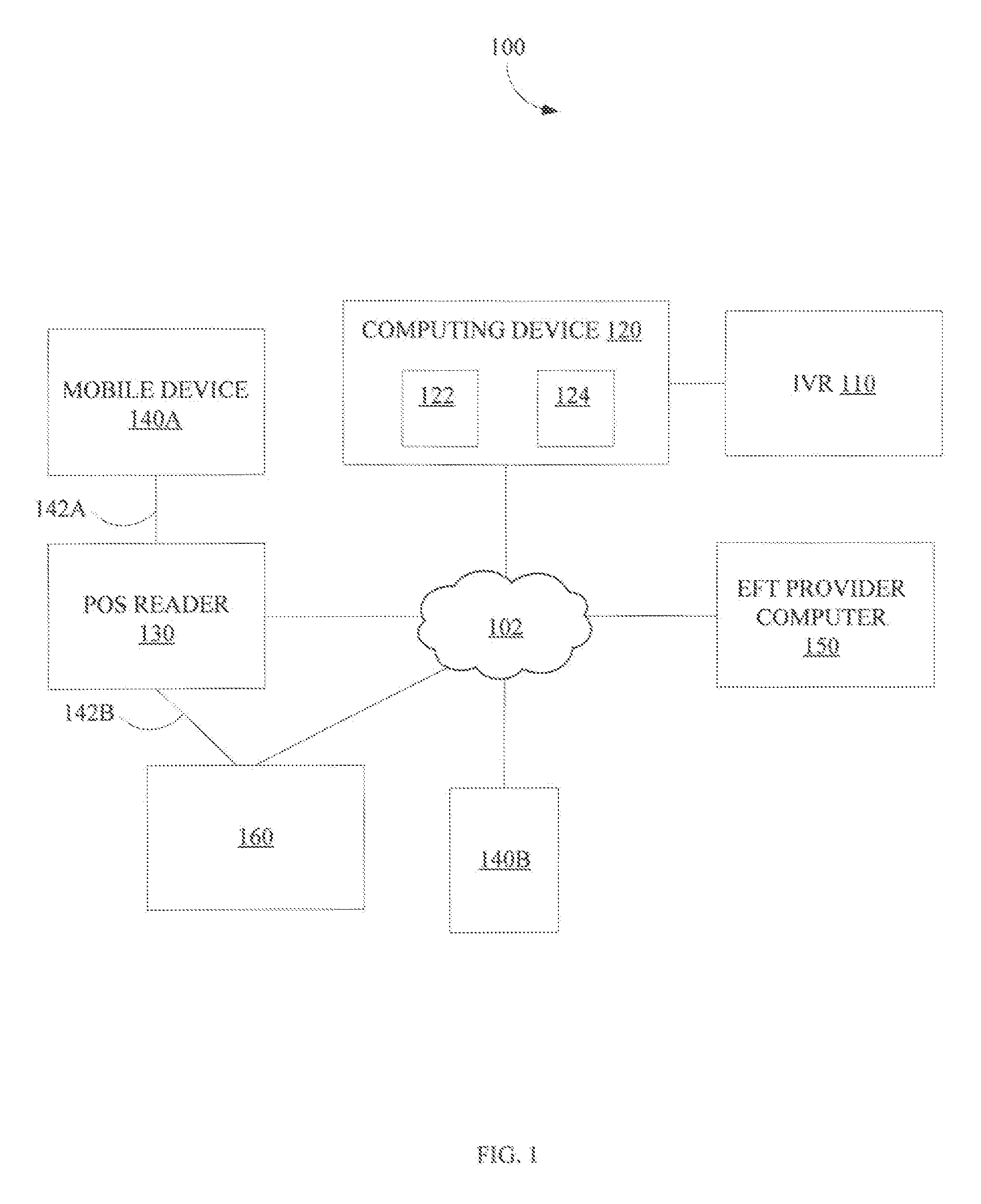

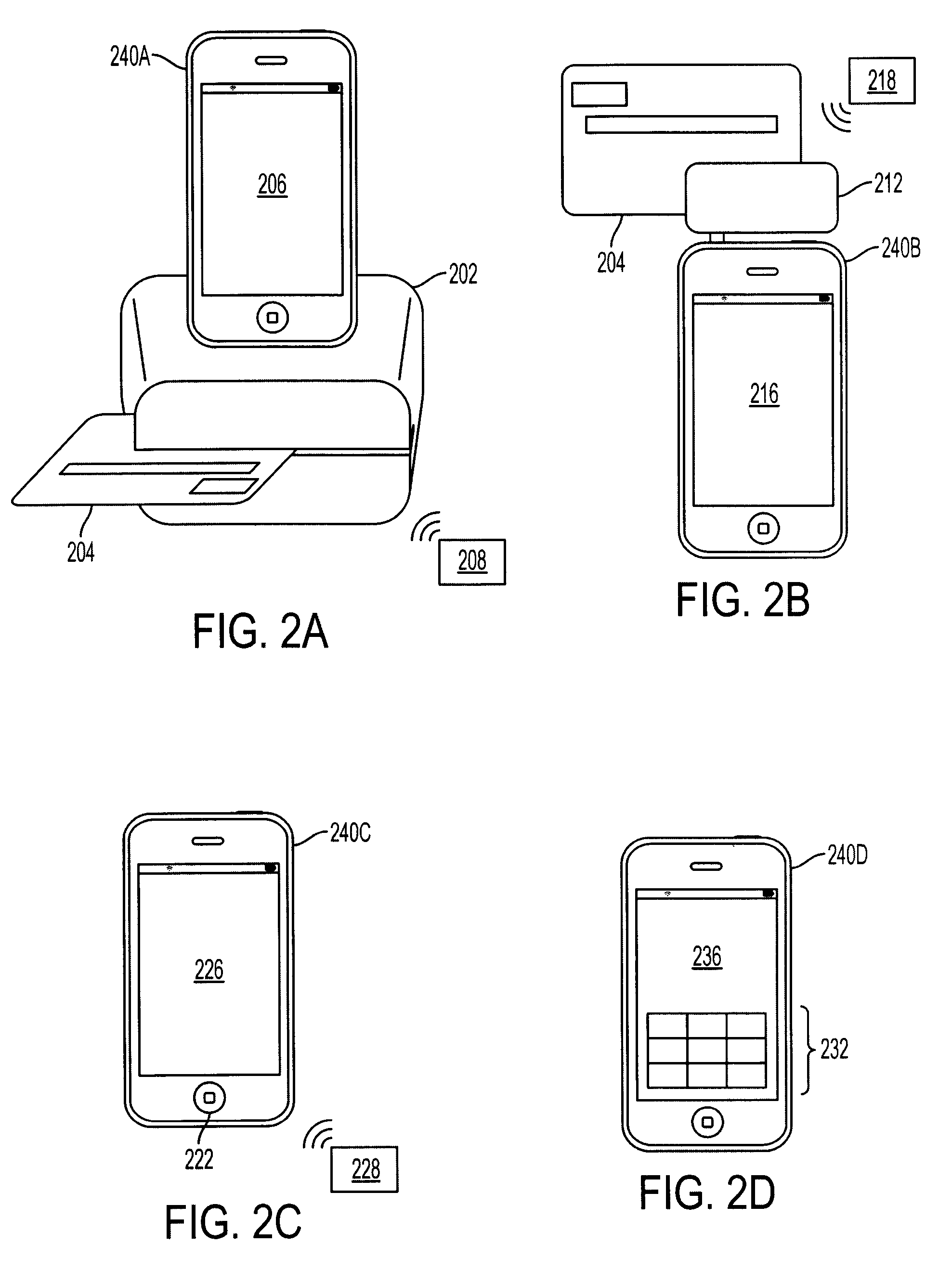

System and Method of Multi-Factor Balance Inquiry and Electronic Funds Transfer

A system and method of processing balance inquiries and electronic funds transfers (EFTs) using multi-factor authentication. The method may include receiving an identifier of a financial account and contact information associated with the financial account and initiating a communication via the contact information. Upon receiving an authentication via the communication, the method may include processing a balance inquiry and / or EFT of the financial account based on the identifier and the authentication. The method may include determining a balance of the financial account based on the balance inquiry and / or causing funds to be electronically transferred. The system and method may also facilitate a balance inquiry from a mobile device to an EFT provider.

Owner:ITS +1

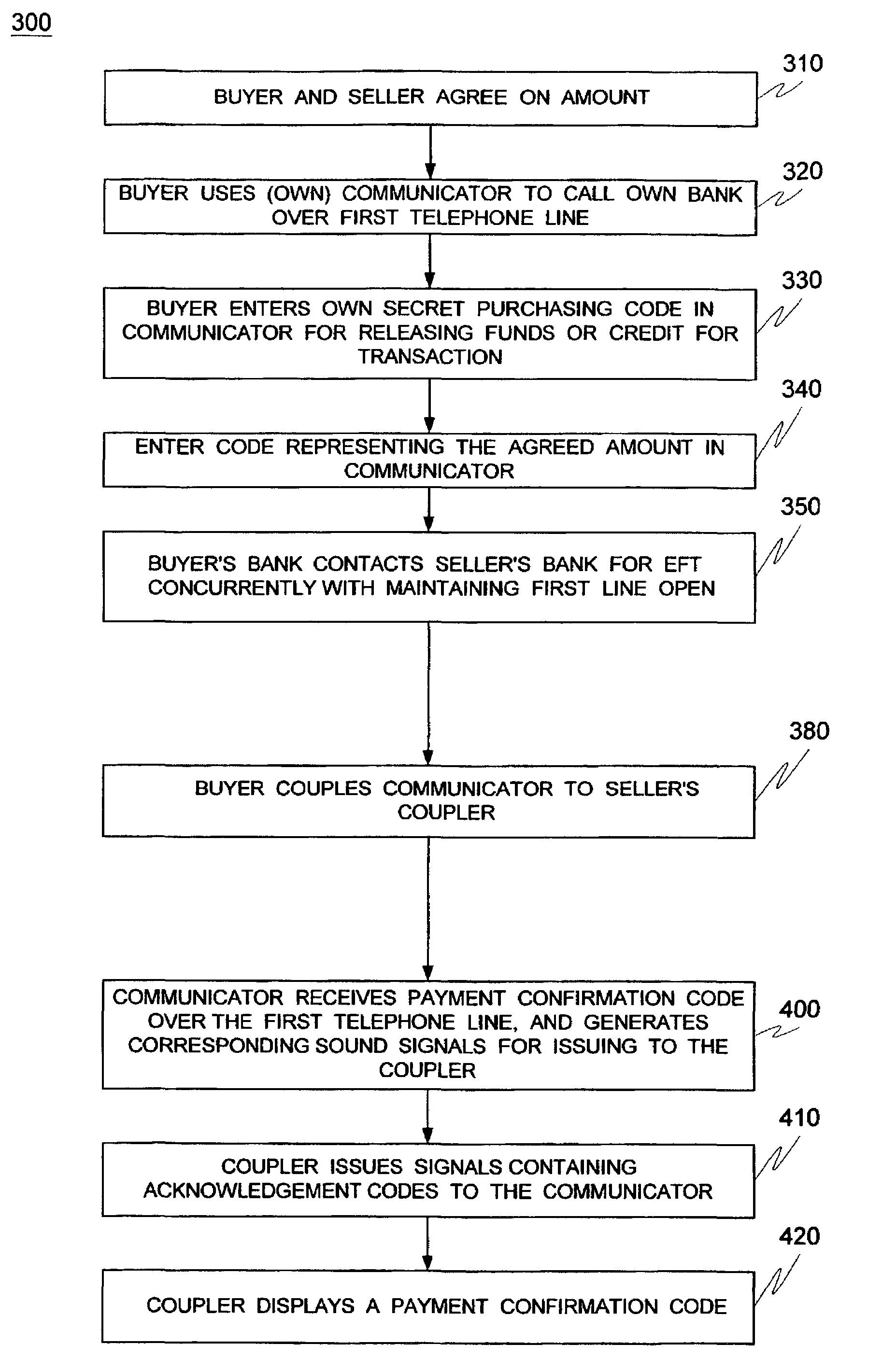

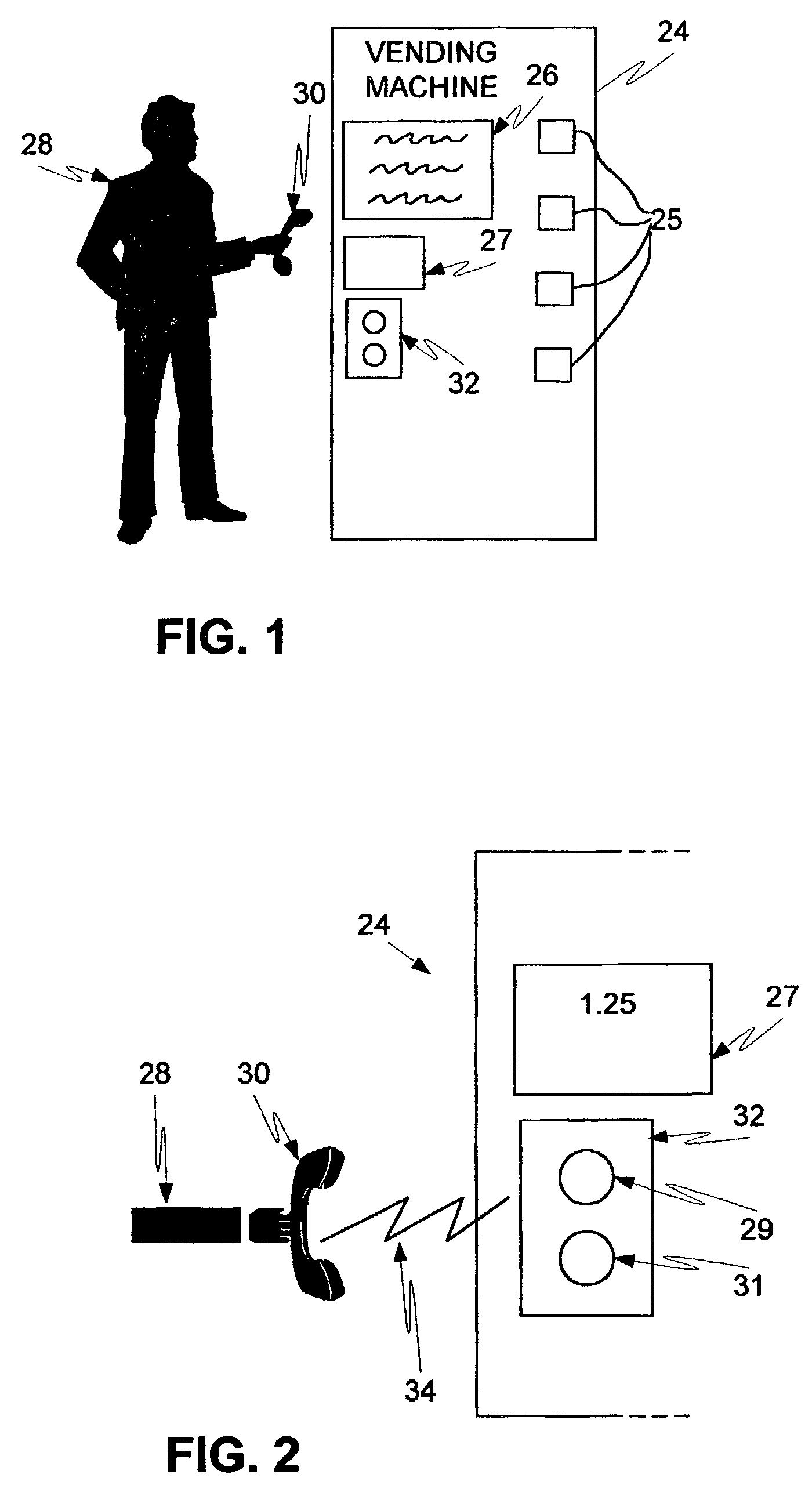

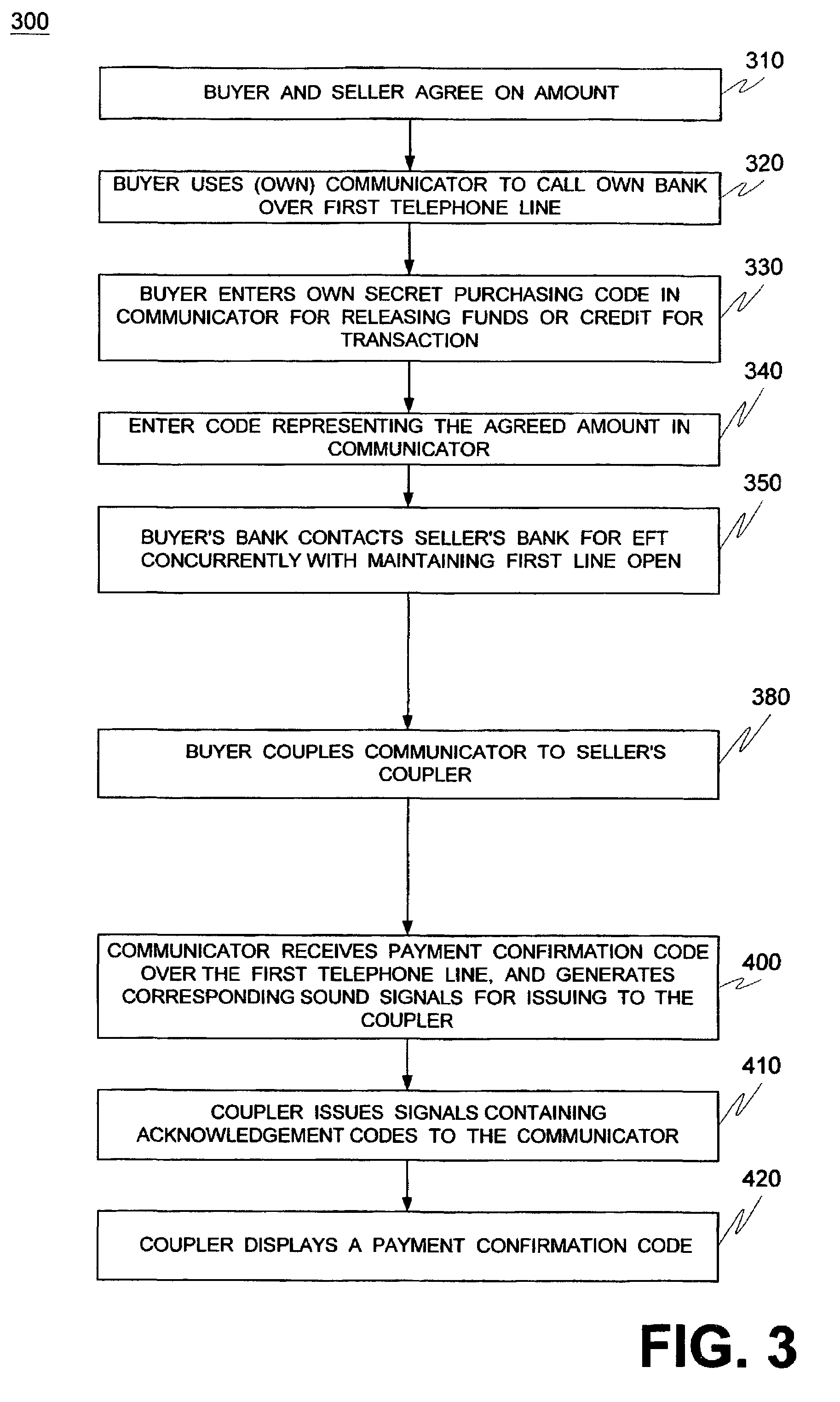

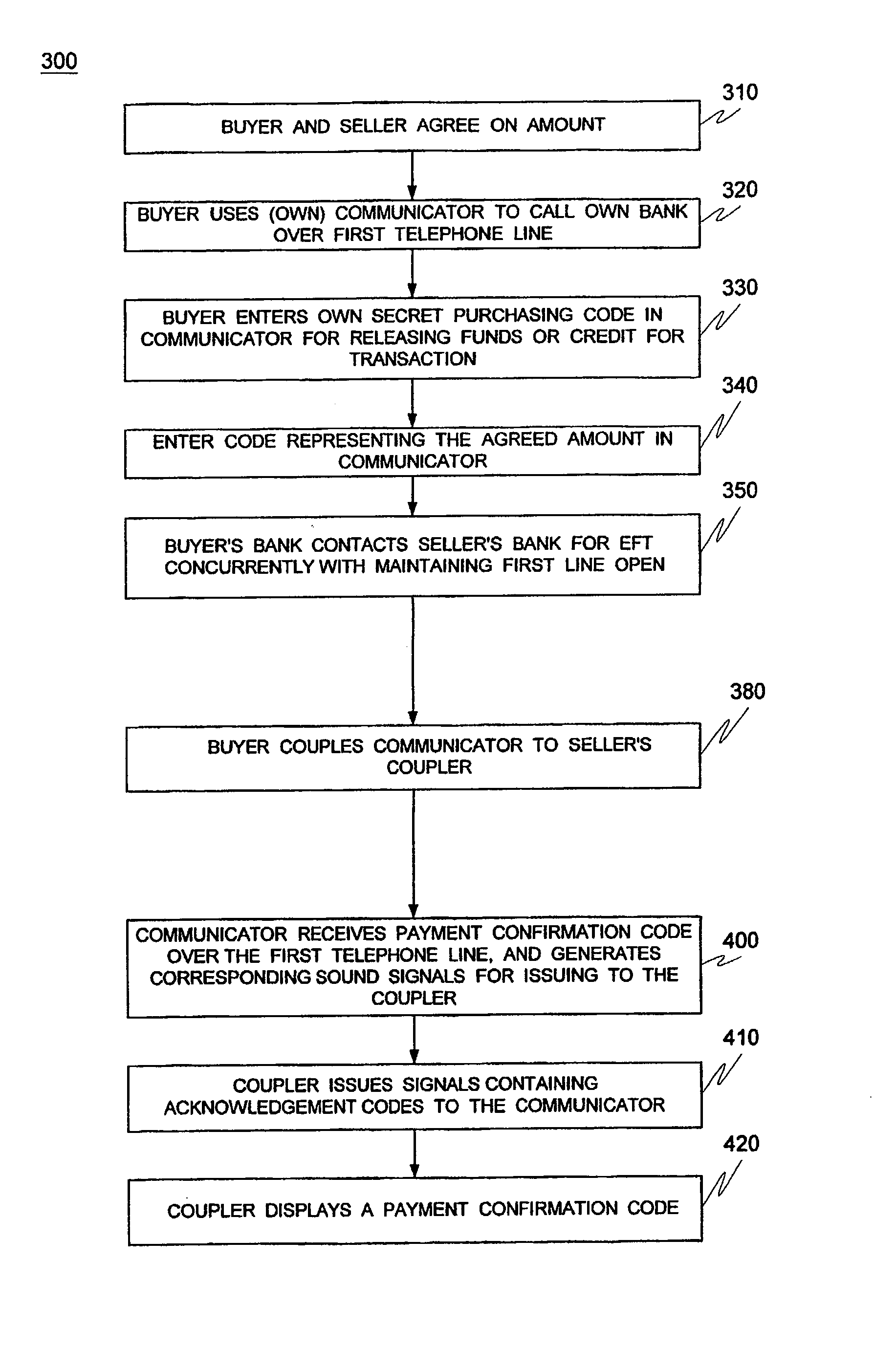

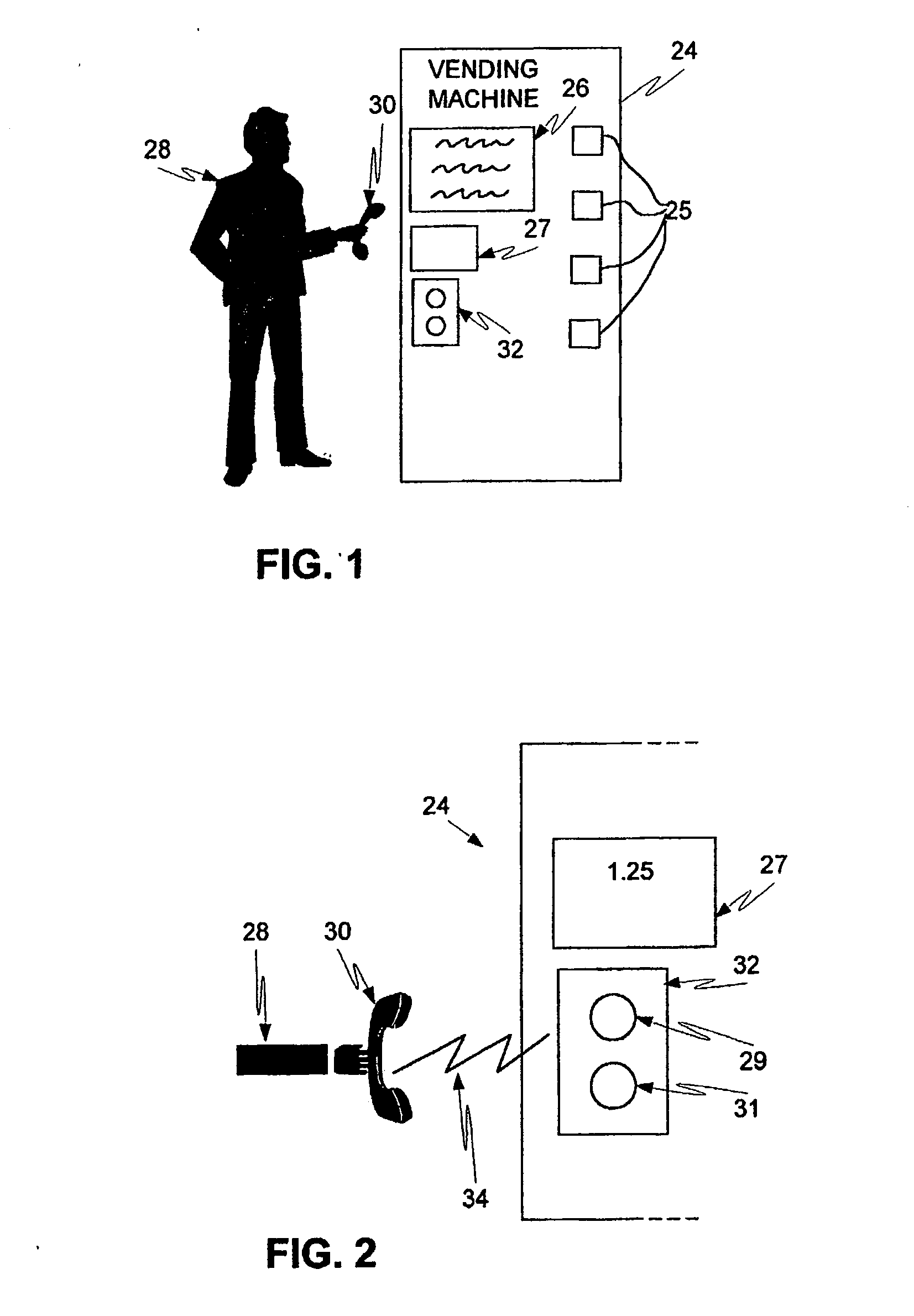

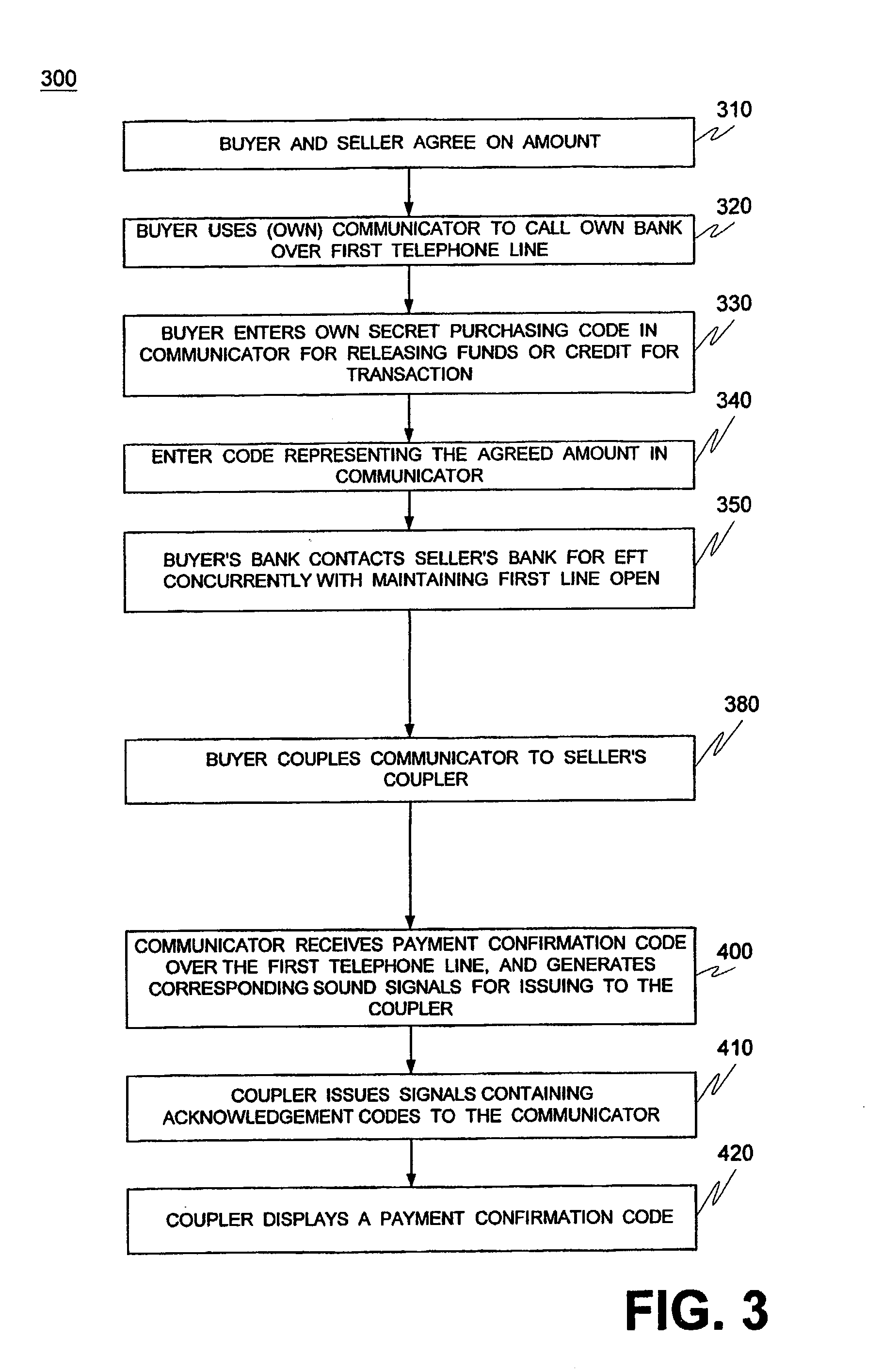

Methods, devices and bank computers for consumers using communicators to wire funds to sellers and vending machines

Methods for consumers to pay at the point of sale by using a personal communicator (30) to wire transfer funds (1364) out of their bank (40) account. The communicator (30) is coupled to, and exchanges signals with a reciprocating communicator (1350) of the seller, which in turn is coupled (1356) to the seller's bank (60). This way the money is transferred as an EFT payment code (1364) directly from the buyer's bank (40) to the seller's bank (60), where it may be considered direct deposited, without processing delays. Devices also include vending machines that can receive payment this way. Bank computers are provided with systems and software for enabling the above. The bank computers are accessible by telephone lines, and work with cooperating banks by exchanging signals, for transferring the funds. The seller's bank (60) generates a payment confirmation code (1368) that is ultimately transmitted to the seller's satisfaction for releasing the goods at the point of sale.

Owner:XYLON LLC

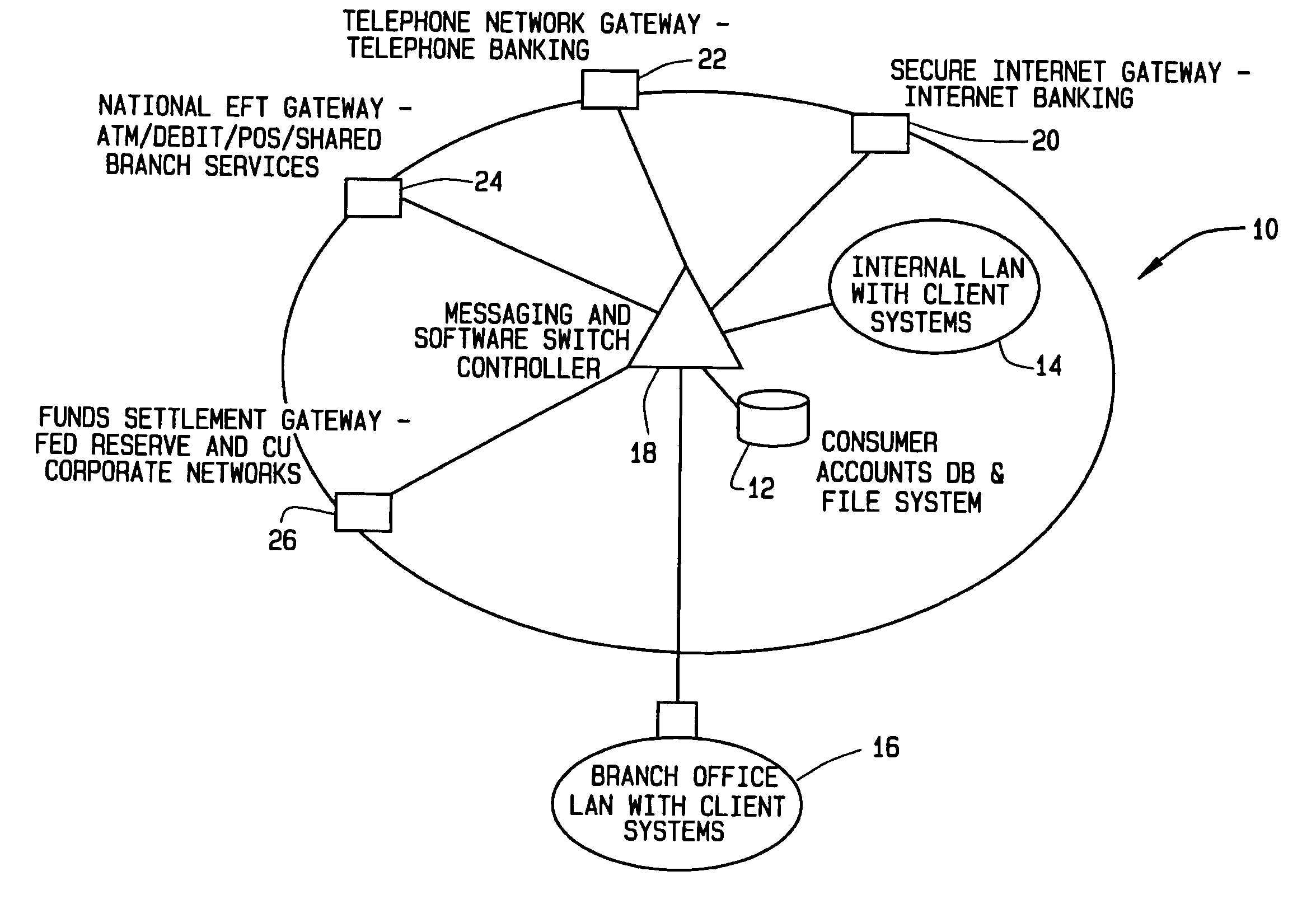

Methods and systems for processing, accounting, and administration of stored value cards

Methods are described for accounting, administration and processing of transactions utilizing a stored value card utilizing an EFT service gateway and providing balances for the cards across a plurality of point of sale devices. One method includes receiving a message generated by the point of sale system of a merchant and parsing the message into data elements. The method also includes routing the message through a switch controller to an account holder database based on an institution ID and a branch ID, accessing an account within the database utilizing the account key, and determining if an account holder's monetary balance in the account is greater than or equal to the transaction amount. A message is formatted and one of an authorization approval or a denial based upon the determination is transmitted within the message.

Owner:STOREFINANCIAL LLC +1

System and method for electronic deposit of a financial instrument by banking customers from remote locations by use of a digital image

A system and method for initiating a deposit transaction, where the depositor is a banking customer located at a remote location, and where the item to be deposited is a financial instrument, such as a paper check from a third party, payable to the depositor. The enabling system features a Remote Customer Terminal (RCT) with certain input devices, connected to a bank system. An image and / or other data of the financial instrument are transmitted from the RCT to the Bank of First Deposit (BOFD) where the data may be processed by conversion to Electronic Funds Transfer (EFT), via Electronic Check Presentment (ECP), or via check reconstruction. The deposit transaction can be accomplished without physical transfer of the financial instrument to or through the bank system. The system and method provide convenience and improved transaction processing speed compared to other deposit transactions of financial instruments.

Owner:JPMORGAN CHASE BANK NA

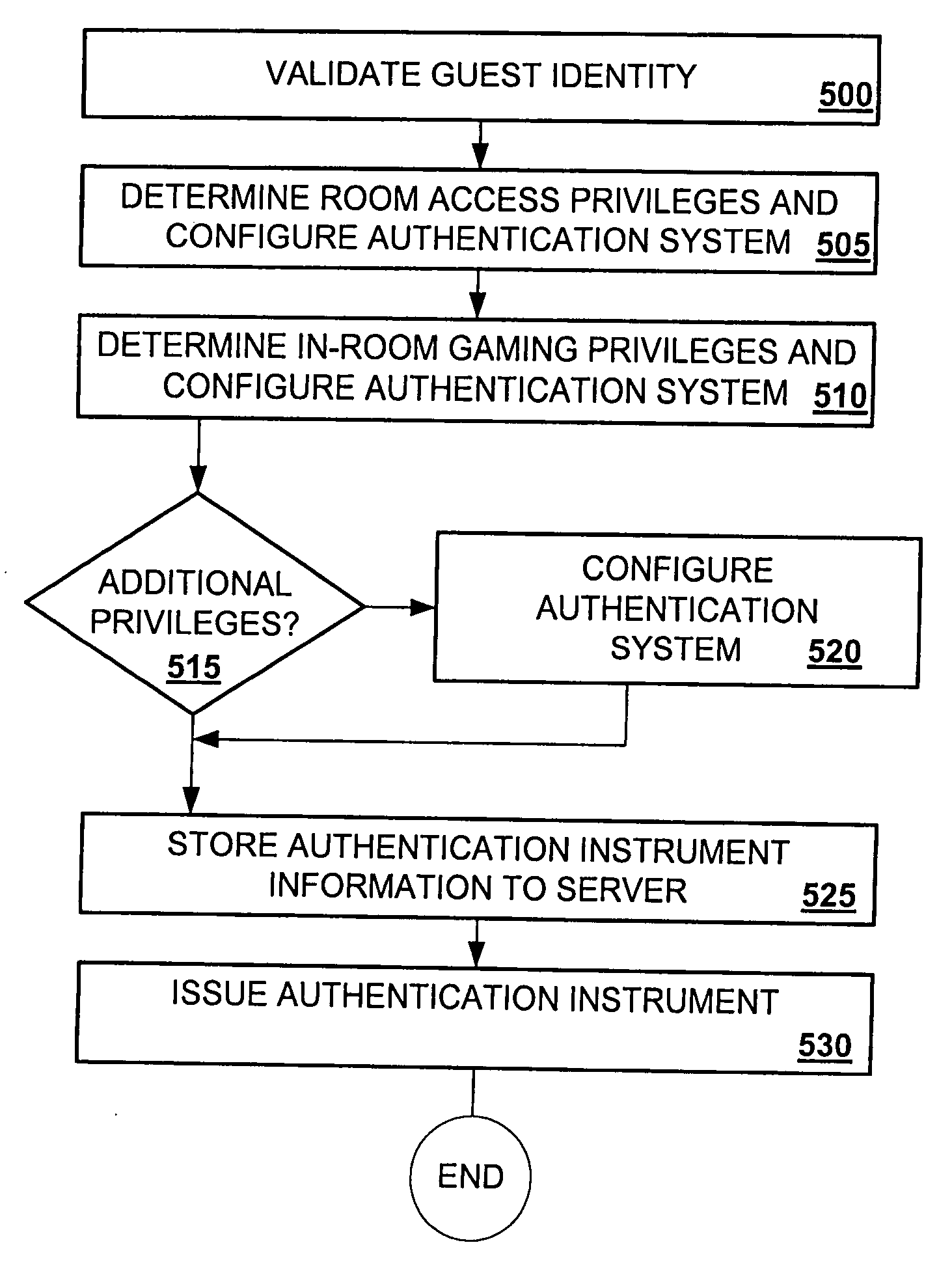

Room key based in-room player tracking

A disclosed authentication instrument is used to authorize various services at a hotel-casino complex, such as but not limited to in-room gaming, in-room sports wagering, room access, safe access, mini-bar access, Electronic Fund Transfers (EFT), player tracking services and in-room entertainment services (e.g., video games and movie channels). A smart card, an electronic token and a magnetic striped card are examples of hardware that may be used as authentication instruments. For in-room gaming, the authentication instrument may be used to authorize, in a secure and legal manner, in-room game play sessions on an entertainment terminal connected to a remote gaming machine.

Owner:IGT

Methods, devices and bank computers for consumers using communicators to wire funds to sellers and vending machines

Owner:XYLON LLC

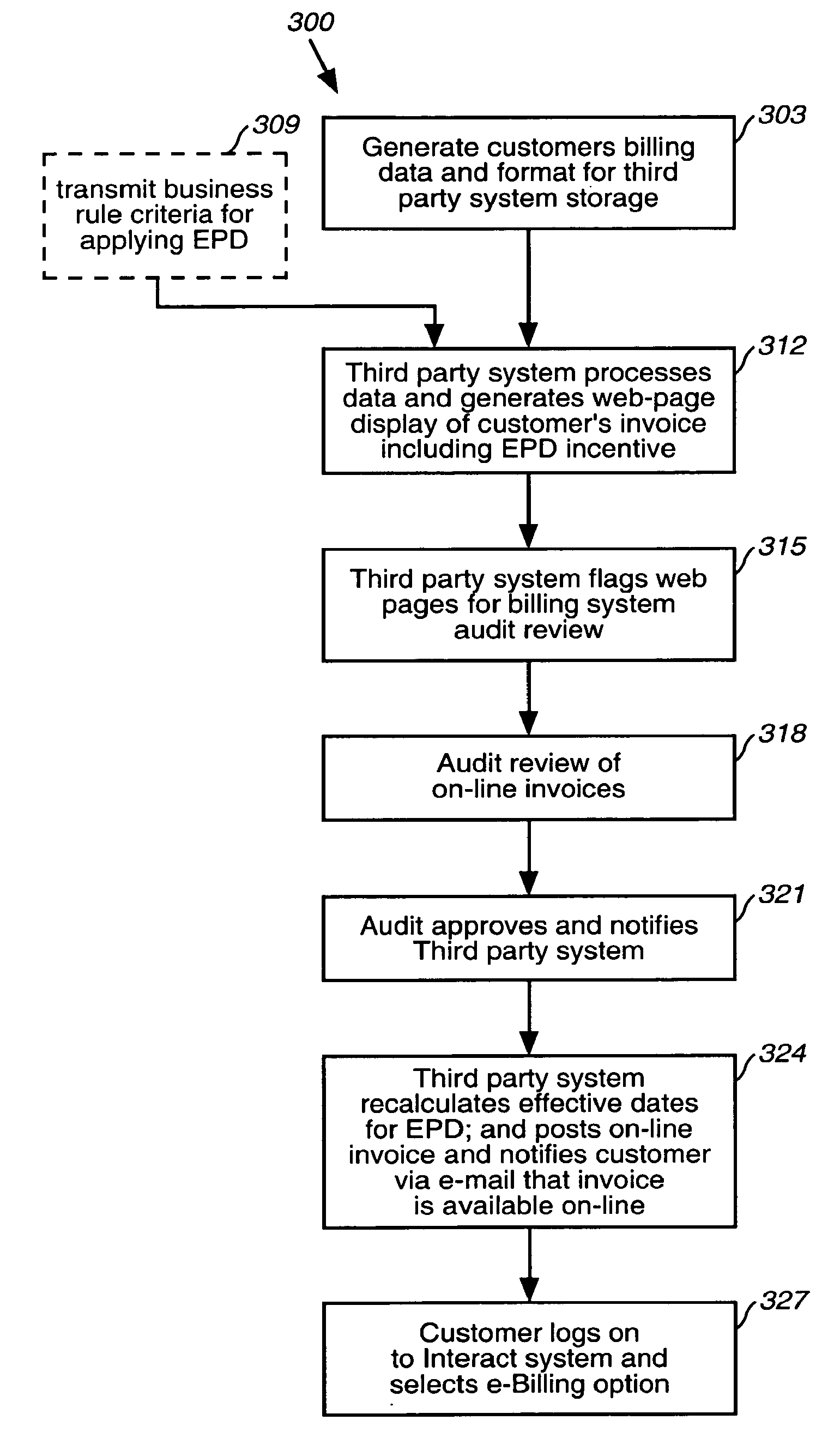

Early-payment discount for E-billing system

ActiveUS7881962B2Reduces the enterprises “Days Receivable OutstandingComplete banking machinesDiscounts/incentivesInvoiceEFTS

An Early Payment Discount (EPD) mechanism that enables customers to automatically receive an early payment discount for paying their invoice electronically, e.g., via electronic funds transfer (EFT), through an e-Billing system within a designated number of days from on-line invoice post date.

Owner:RAKUTEN GRP INC

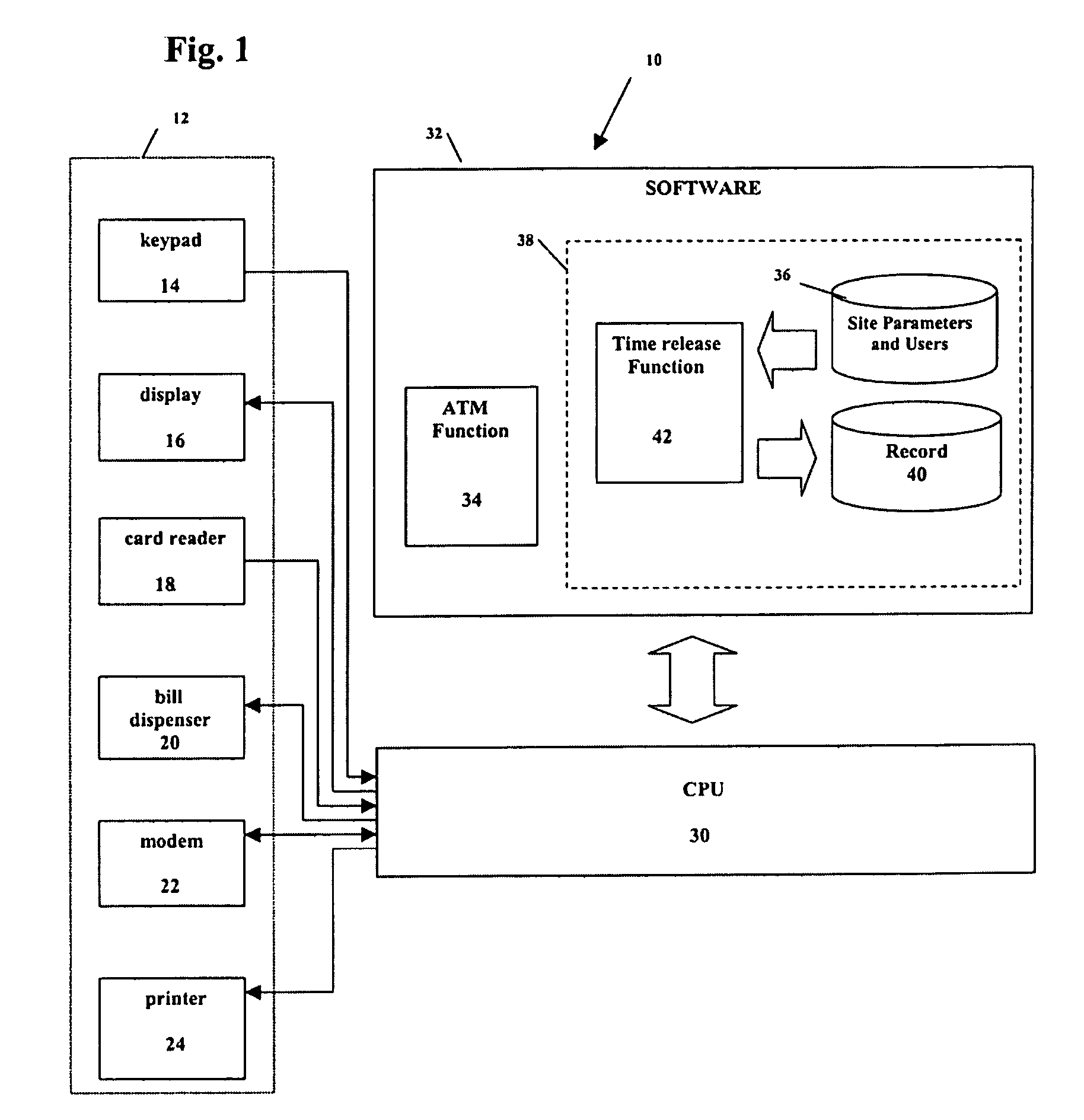

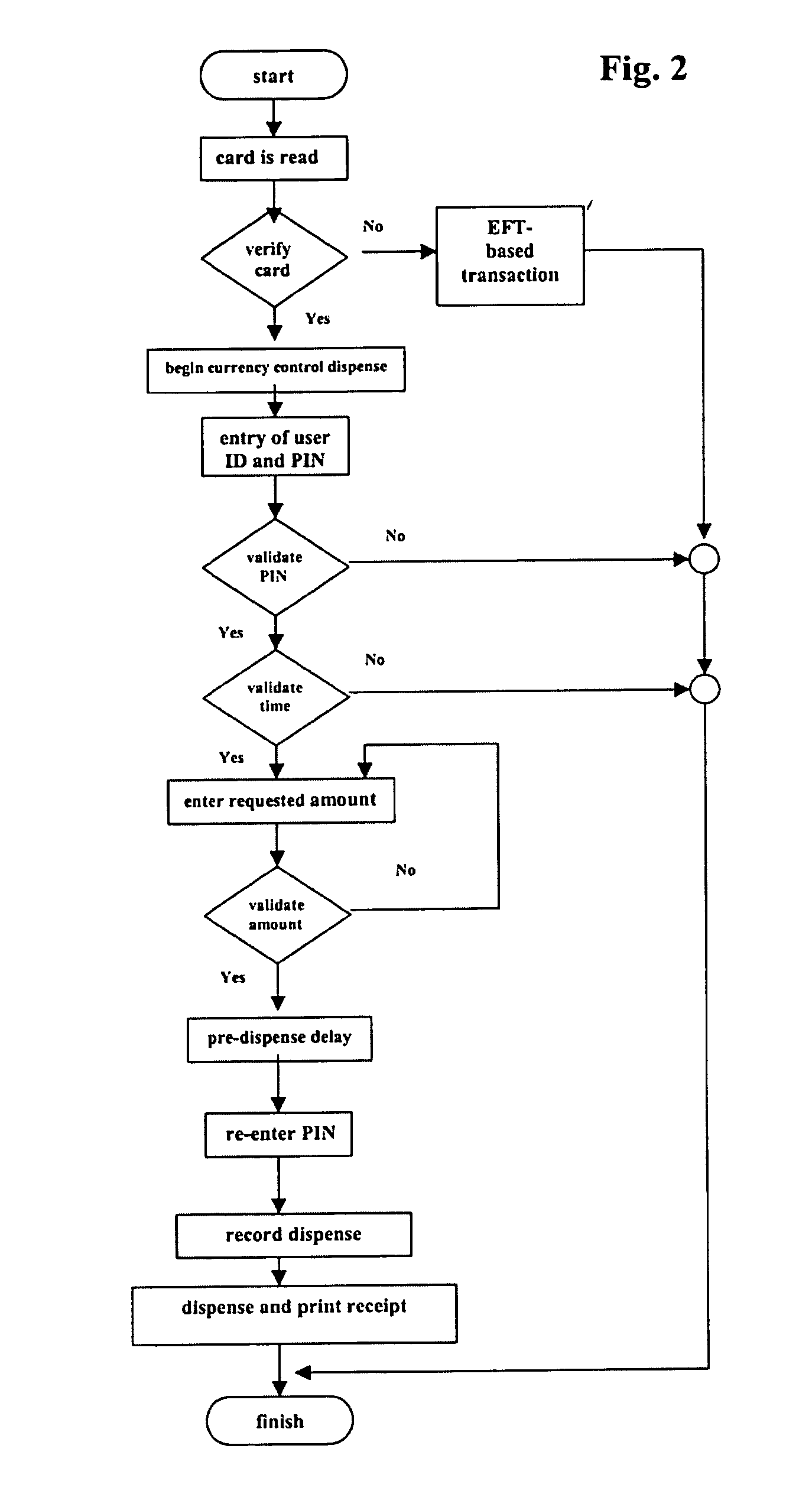

Remote currency dispensation systems and methods

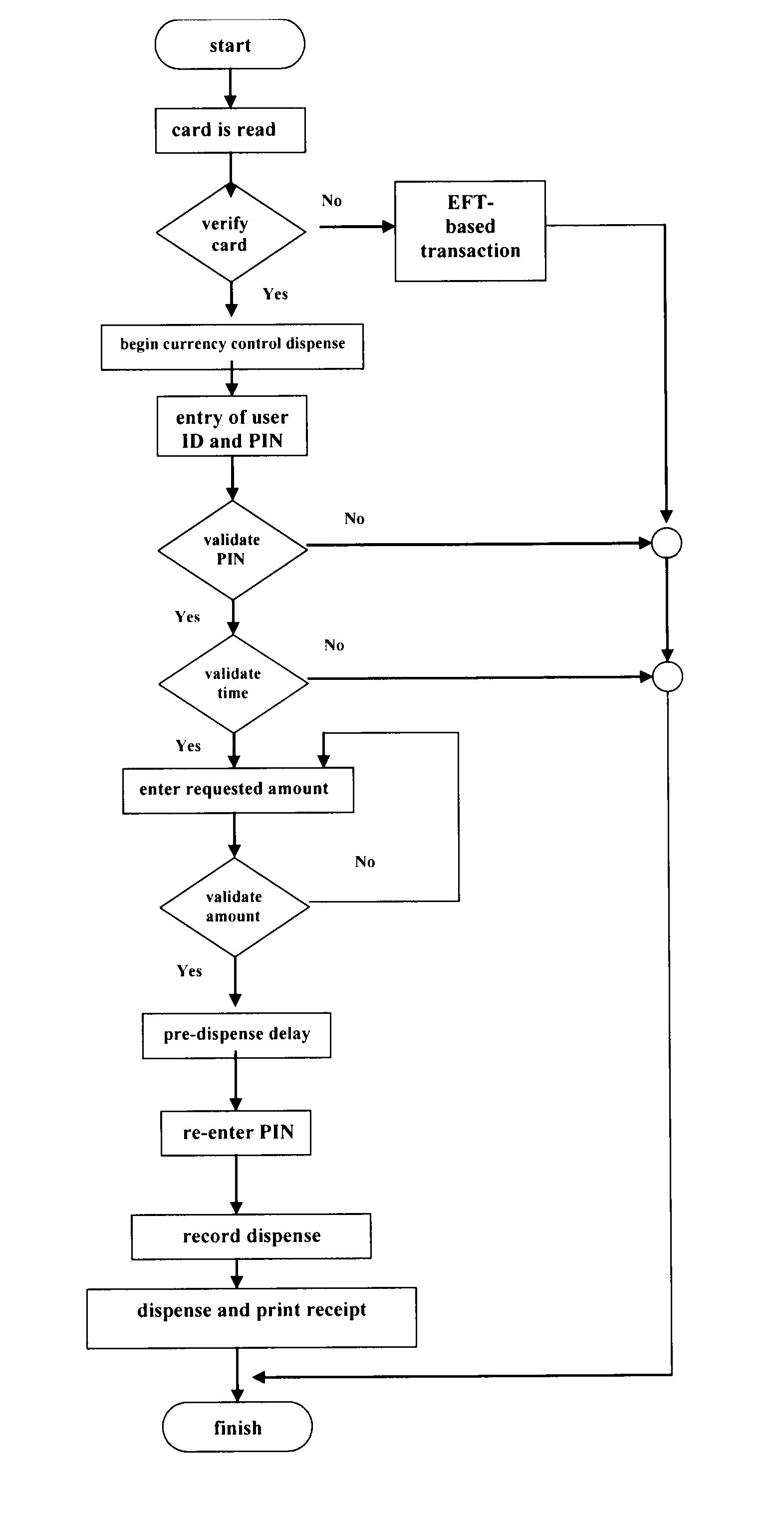

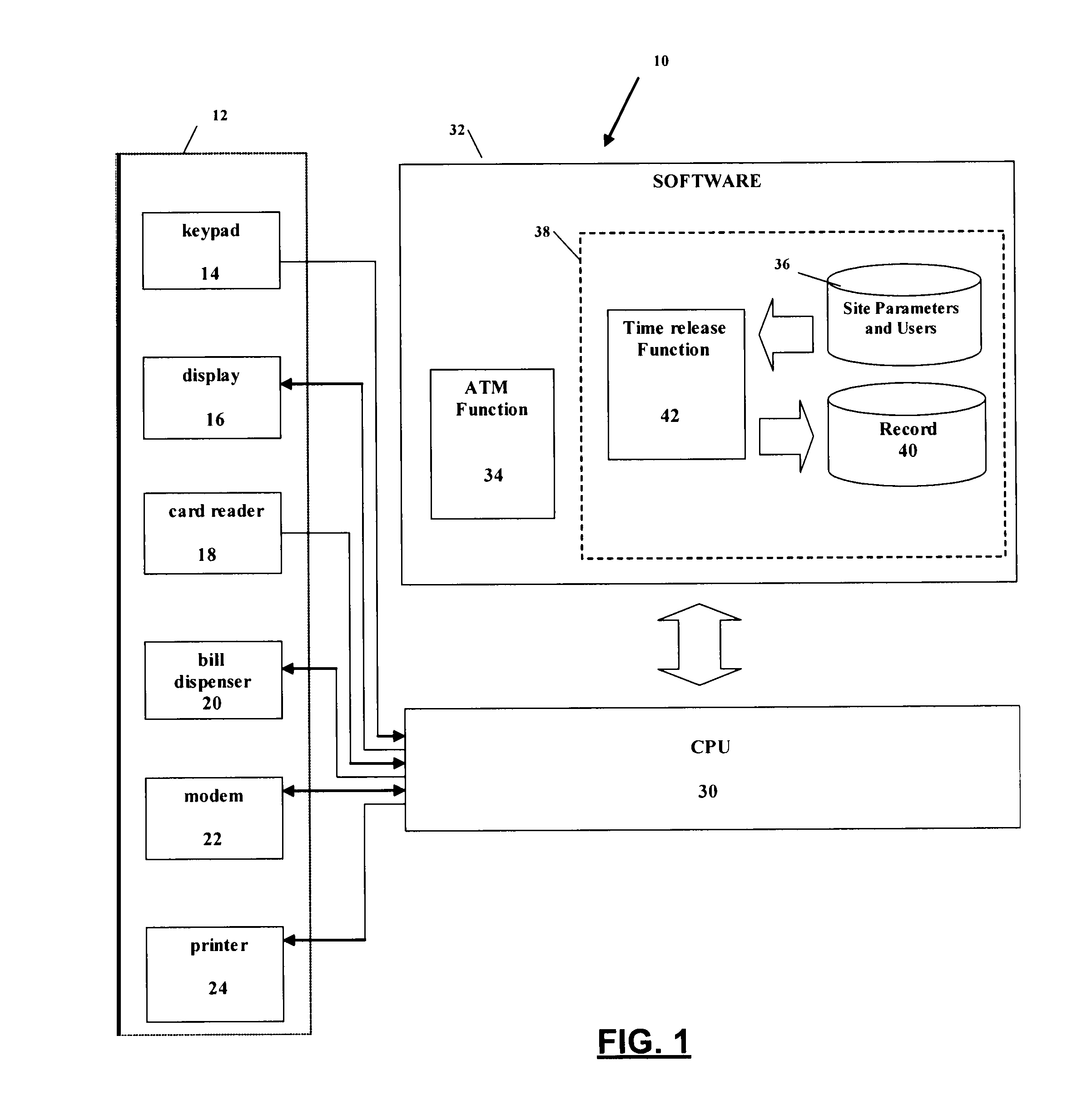

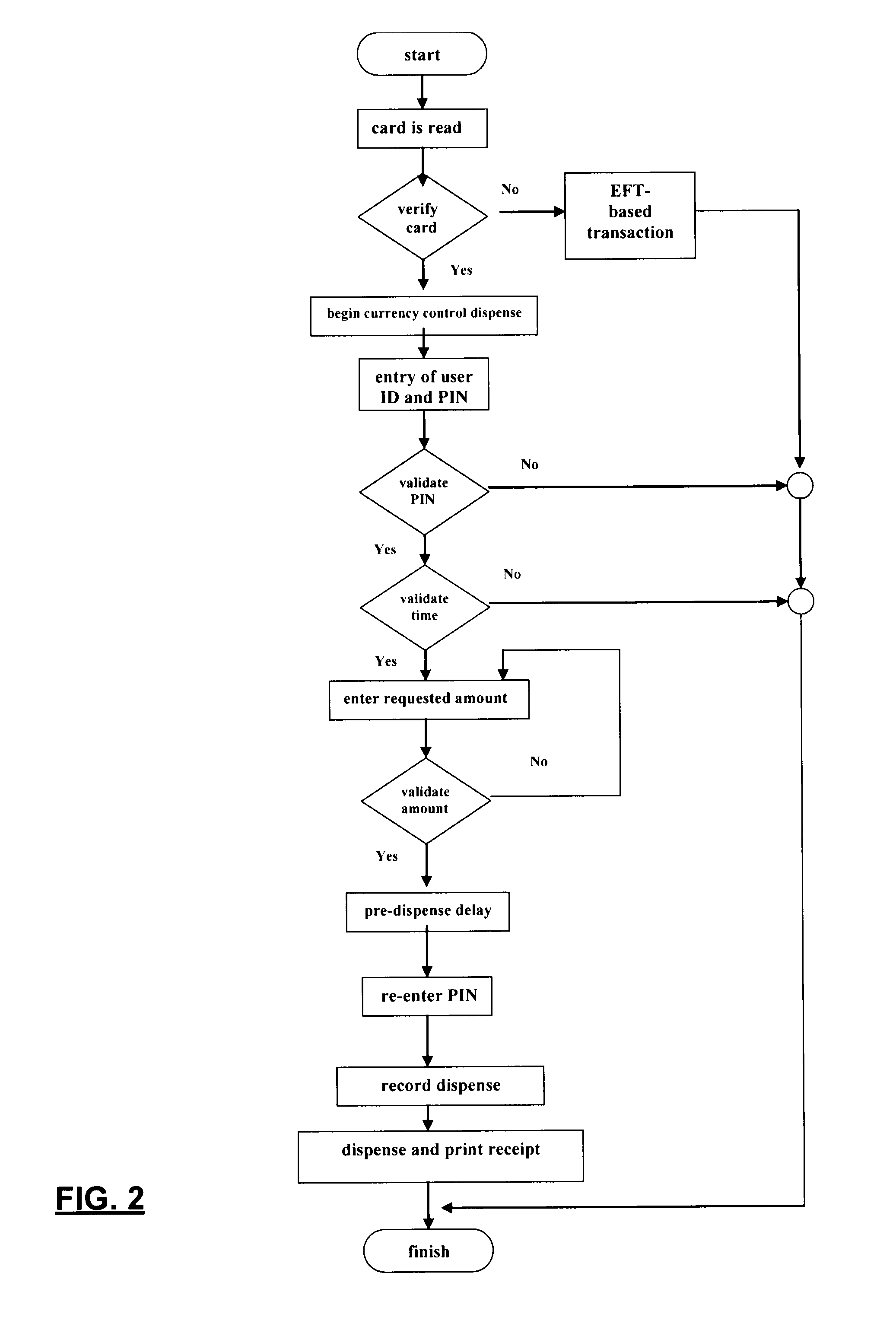

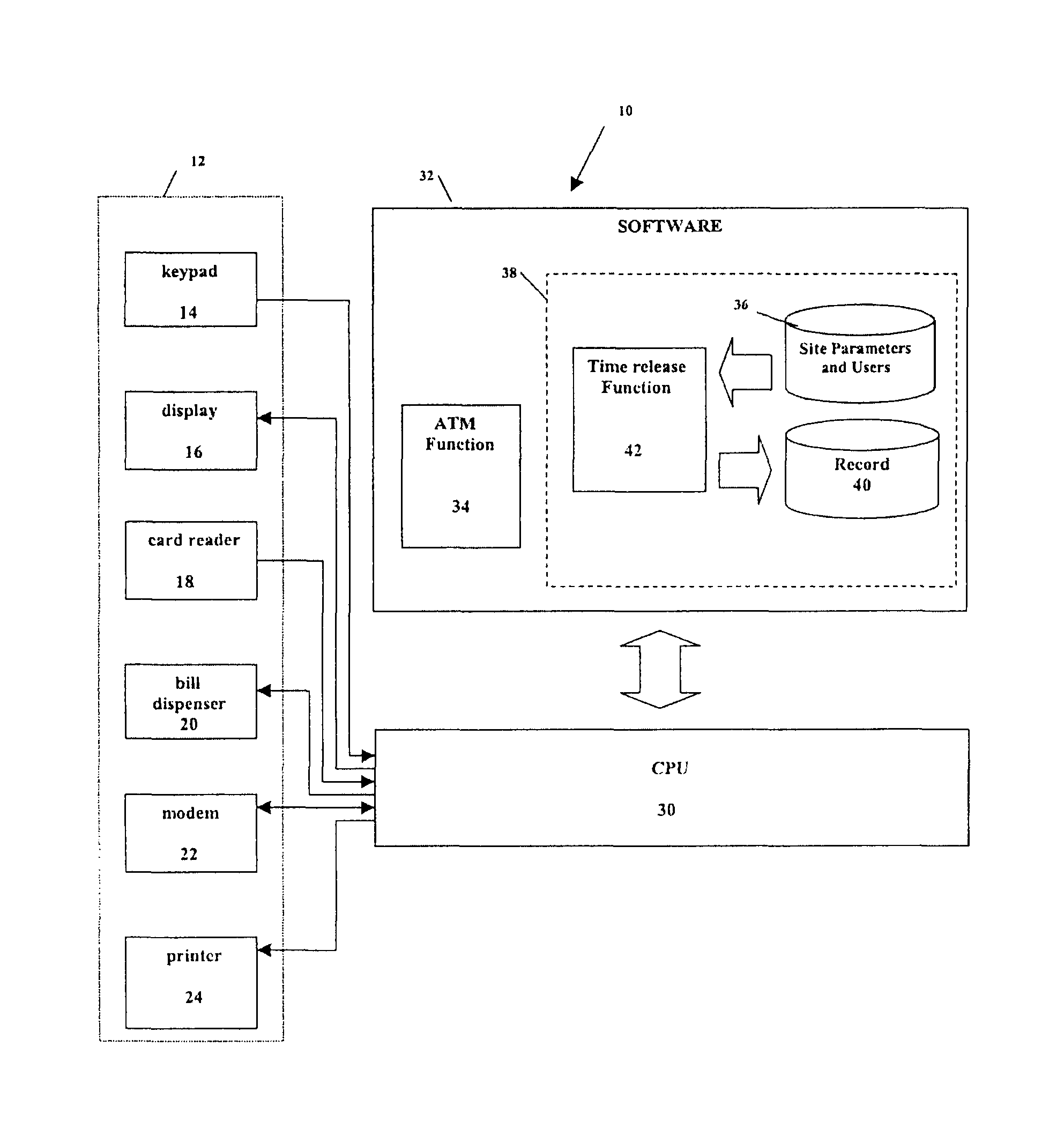

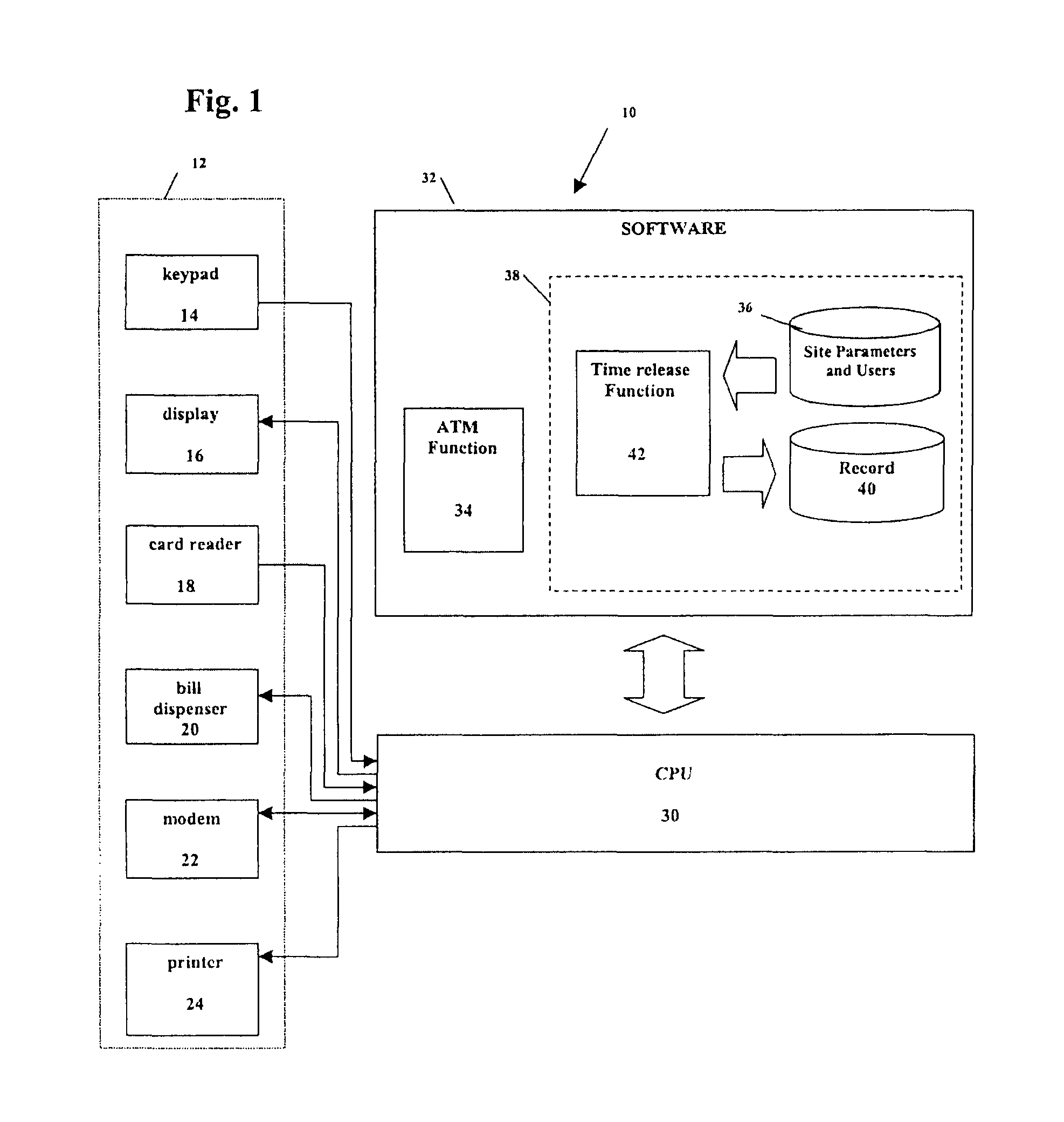

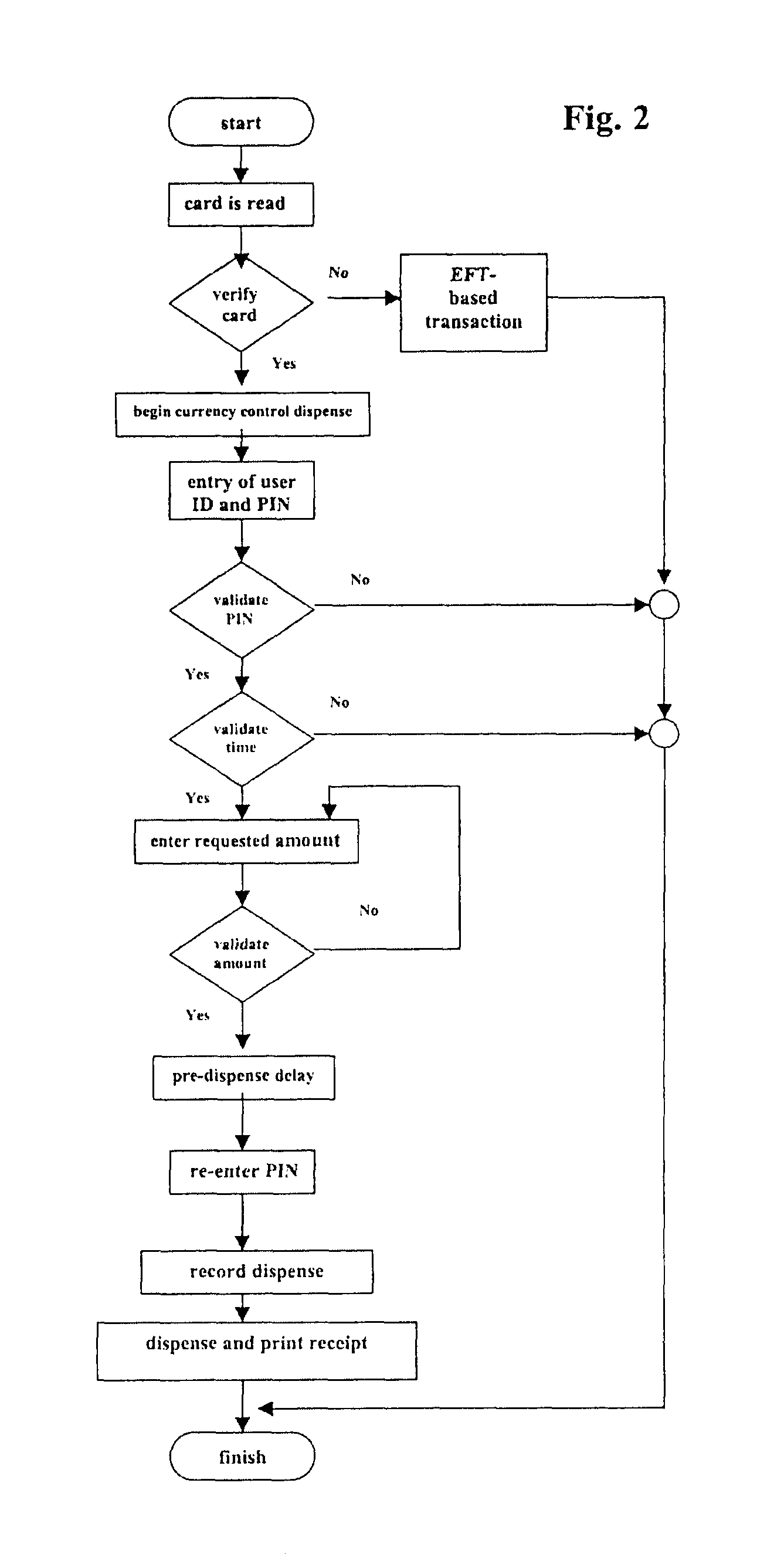

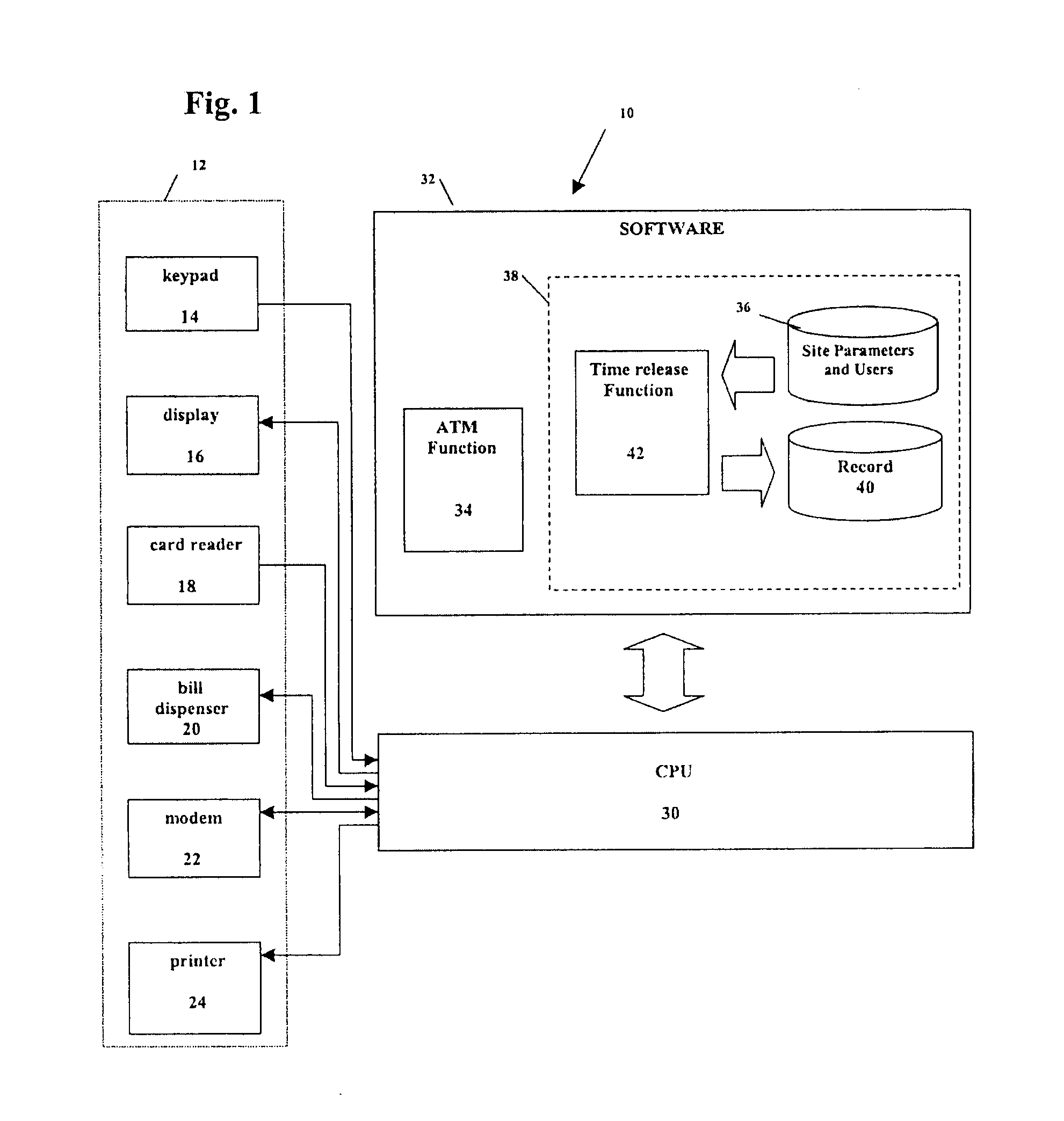

A currency dispense and control system (CDCS) for securely dispensing paper currency in multiple modes: (1) an ATM system and (2) a currency control system that allows a merchant or merchant-approved employee to withdraw cash from the CDCS independent of a standard ATM electronic fund transfer (EFT) network. The CDCS may be on-site and implemented using standard ATM hardware or may be located remotely. The CDCS may also include one or more of the following functionalities: a duress dispensation system that allows the CDCS to activate an alarm and / or otherwise communicate with local police or security services during a robbery, a time-release system that effects a time-delayed dispensation functionality, and a user identification and authentication system for authenticating a user identity and determining eligibility of the user to access the currency control system.

Owner:PEREGRIN TECH

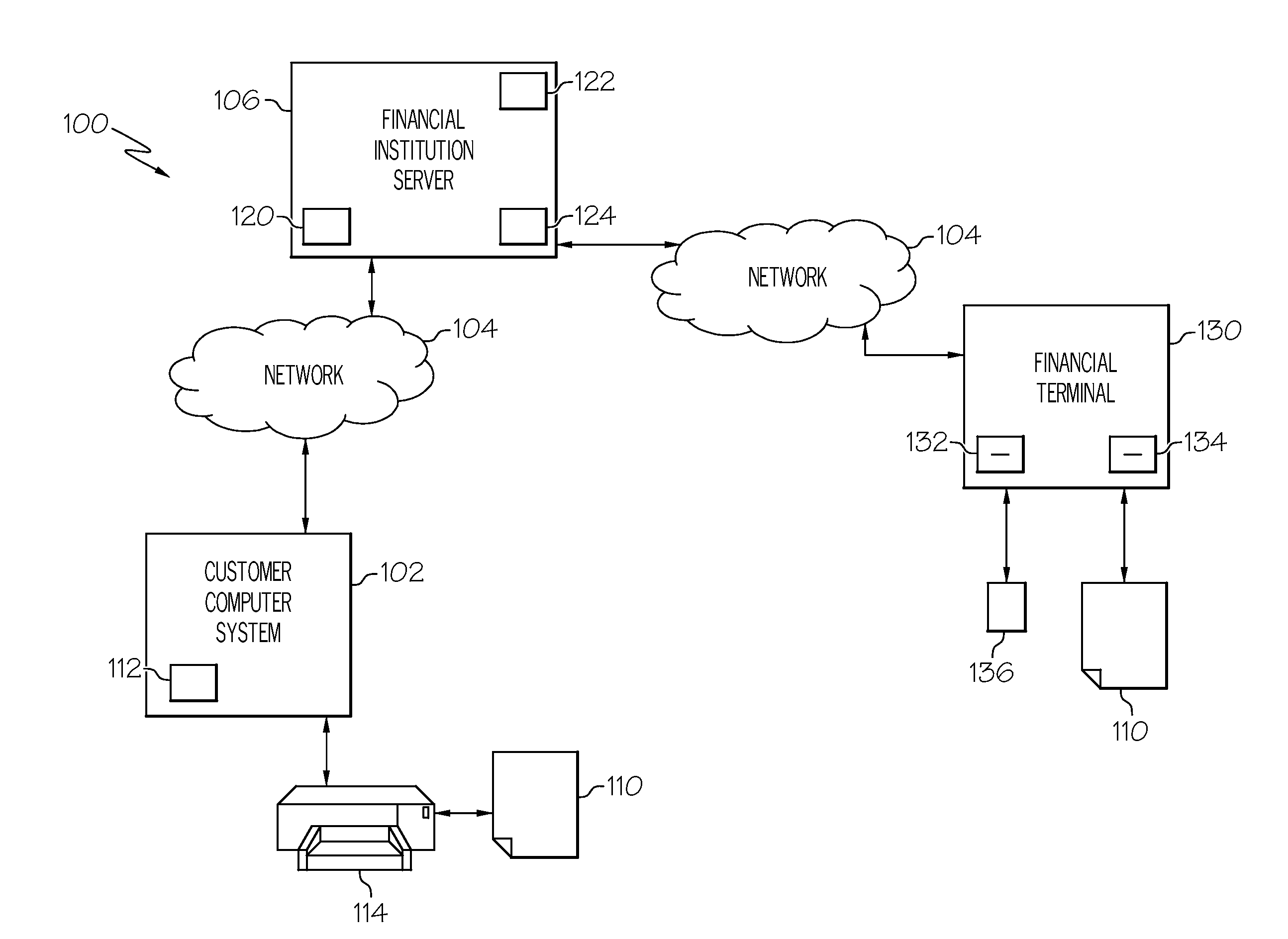

Guest limited authorization for electronic financial transaction cards

Generally speaking, methods and media for authorizing a guest to use an electronic financial transaction card, such as a credit card or debit card, are disclosed. Embodiments may include receiving information about a desired guest transaction (which may be limited in size, timeframe, nature, etc.) from a customer associated with an EFT card, generating a guest PIN number and artifact information for the guest transaction, and transmitting them to the customer. Embodiments may also include receiving from a financial terminal a PIN number and an indication of a supplied artifact associated with a proposed transaction utilizing the EFT card. Embodiments may include determining whether the proposed transaction should be authorized based on the received PIN number and the supplied artifact and, in response to determining that the proposed transaction should be authorized, transmitting approval of the proposed transaction to the financial terminal.

Owner:PAYPAL INC

Currency dispense and control system with anti-theft features

InactiveUS7726557B2Improved cost-effectiveComplete banking machinesFinanceCost effectivenessControl system

A cost-effective, currency dispense and control system (CDCS) securely dispenses paper money in one of the following modes: (1) an ATM system and (2) a currency control system that allows a merchant or merchant-approved employee to withdraw cash from the CDCS independent of a standard ATM electronic fund transfer (EFT) network. The CDCS may also include the following functionalities: a duress dispensation system that allows the CDCS to activate an alarm and / or otherwise communicate with local police or security services during a robbery, a time-release system that effects a time-delayed dispensation functionality, and a user identification and authentication system for authenticating a user identity and determining eligibility of the user to access the currency control system.

Owner:PEREGRIN TECH

System and method for electronic deposit of a financial instrument by banking customers from remote locations by use of a digital image

Owner:JPMORGAN CHASE BANK NA

Remote currency dispensation systems and methods

Owner:PEREGRIN TECH

System and method for subband beamforming using adaptive weight normalization

ActiveUS6980614B2Remove distortionCancel improvementSpatial transmit diversityPolarisation/directional diversityFourier transform on finite groupsEngineering

A beamforming system and method. The inventive beamforming system is adapted for use with an array antenna having a plurality of antenna elements and includes a Fast Fourier Transform (EFT) for transforming a signal received by an antenna into a plurality of frequency subbands. A plurality of adaptive processors are included for performing adaptive array processing on each of the subbands and providing a plurality of adaptively processed subbands in response thereto. A normalizing processor is also included for normalizing the adaptively processed subbands. In the illustrative embodiment, the signal is a Global Positioning System (GPS) signal and a digital multiplier for applying a weight to a respective frequency subband for each of the elements of the array. The weights are chosen to steer a beam in a direction of a desired signal. Normalization involves adjusting the amplitude of one or more of the subbands to remove any bias distortion due to the adaptive processing thereof.

Owner:RAYTHEON CO

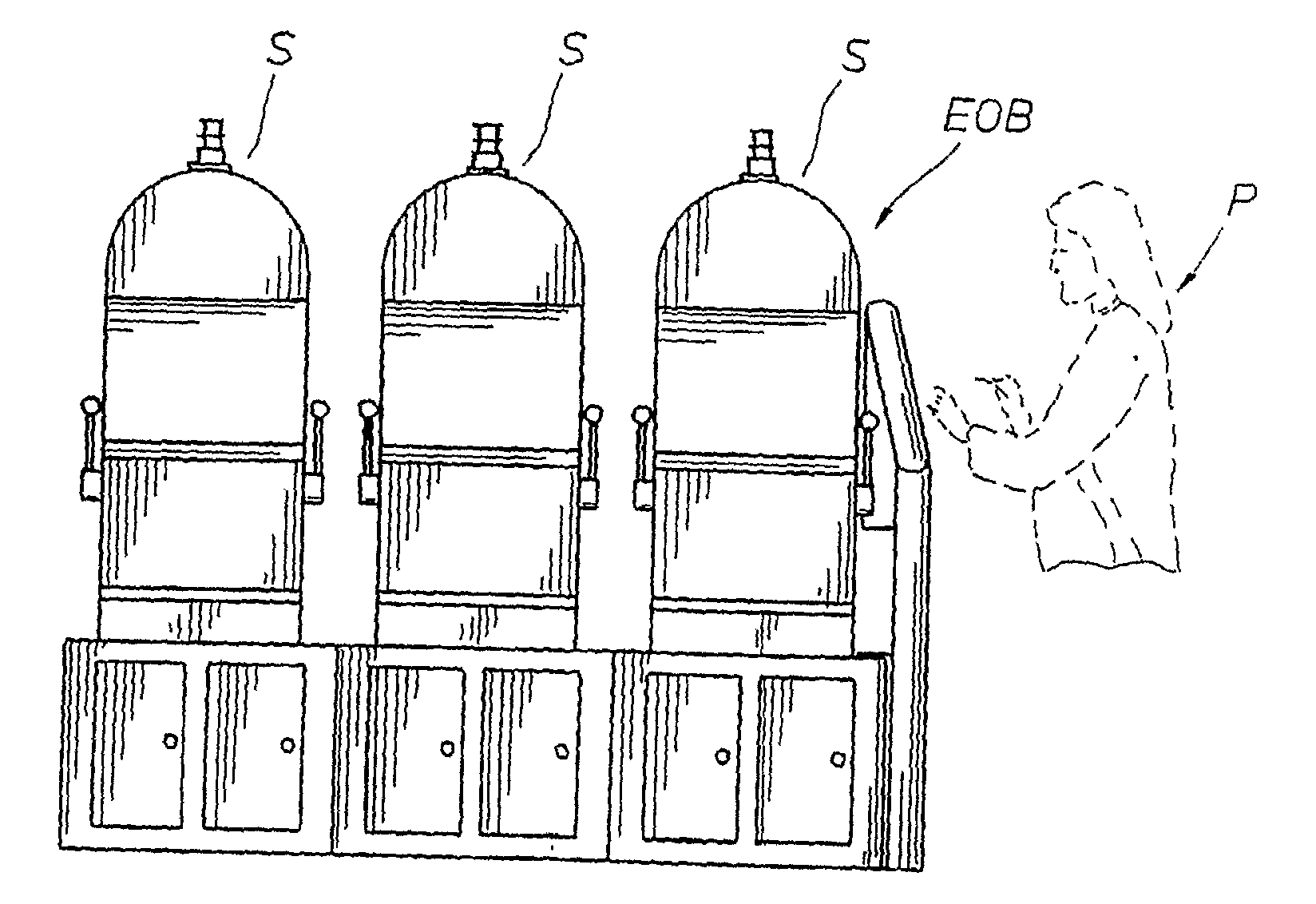

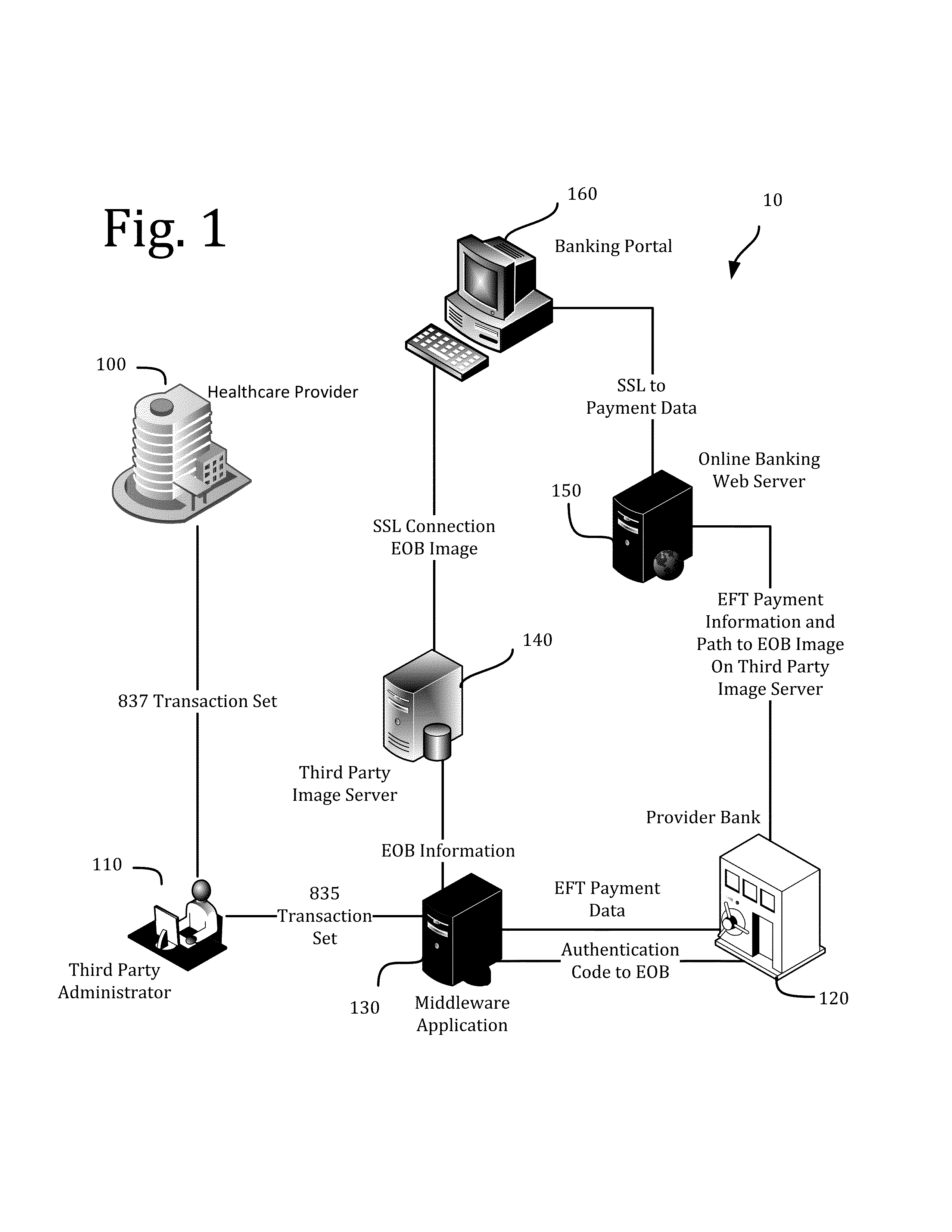

Integrated payment and explanation of benefits presentation method for healthcare providers

A method for facilitating the delivery of electronic funds and conveying an explanation of benefits to a service provider is described herein. A claim for payment by a service provider (such as a physician's office) is adjudicated by a third party administrator. An electronic funds transfer (EFT) is generated under a transaction set specification that encodes both payment information as well as an explanation of benefits (EOB). The EOB indicates which charges were approved and / or which were denied. The EOB data is extracted from the EFT and an image is generated containing the text of the EOB. The image is created in a format that is compatible with the online delivery of posted-paper checks. When the service provider logs into its bank to reconcile charges the EFT transaction is noted and the provider clicks on the “view check” link to obtain the EOB information.

Owner:STONEEAGLE SERVICES

Currency dispense and control system with anti-theft features

A cost-effective, currency dispense and control system (CDCS) securely dispenses paper money in one of the following modes: (1) an ATM system and (2) a currency control system that allows a merchant or merchant-approved employee to withdraw cash from the CDCS independent of a standard ATM electronic fund transfer (EFT) network. The CDCS may also include the following functionalities: a duress dispensation system that allows the CDCS to activate an alarm and / or otherwise communicate with local police or security services during a robbery, a time-release system that effects a time-delayed dispensation functionality, and a user identification and authentication system for authenticating a user identity and determining eligibility of the user to access the currency control system.

Owner:PEREGRIN TECH

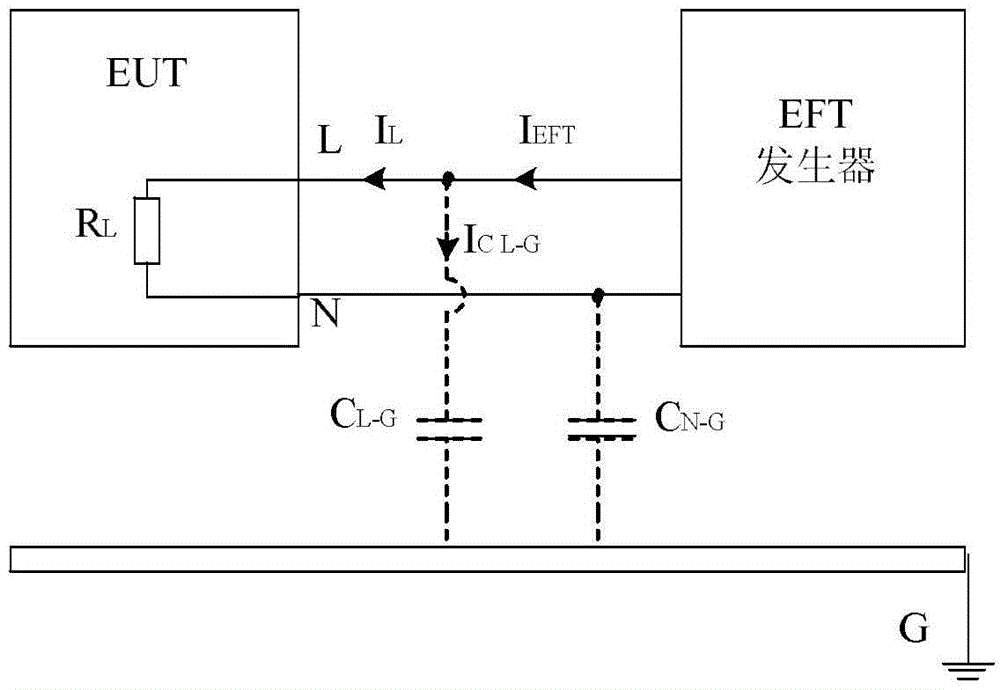

Floating electronic equipment electric rapid transient pulse group protection method

The invention provides a floating electronic equipment electric rapid transient pulse group protection method. One end, close to a grounding panel, of floating electronic equipment is provided with artificial ground. Firstly, a device to be tested, an EFT generator, a socket, and leads are successively connected on an experiment table; secondly, the EFT generator is set to test the device to be tested; thirdly, a 'start' button is started to carry out EFT noise immunity test, if the device to be tested works normally, the test is finished, and if the device to be tested works abnormally, the EFT protection is carried out; and fourthly, the bottom of the casing of the device to be tested is additionally provided with a piece of artificial ground tightly attached to the bottom of the casing of the device to be tested, and the EFT noise immunity test is carried out again. The protection method can effectively avoid EFT interference.

Owner:江苏益邦电力科技有限公司

Device and method for testing electrical fast transient/burst (EFT/B) immunity of electric energy meter

InactiveCN102411135AReduce workloadImprove work efficiencyElectrical measurementsCurrent loadElectricity

The invention discloses a device and a method for testing electrical fast transient / burst (EFT / B) immunity of an electric energy meter, and can be used for testing active load, reactive load and high-current load and the like. In the device, a voltage port of a check device of the electric energy meter is connected with an input port of a power filter of a voltage circuit; an output port of the power filter of the voltage circuit is connected with an input port of an EFT test signal generator; a current port of the check device of the electric energy meter is connected with an input port of a power filter of a current circuit; and a pulse port of the check device of the electric energy meter is connected with an input port of a filter of a pulse circuit. The test method comprises the following steps: during the test, a pulse train interference signal generated by the EFT test signal generator enters the electric energy meter under test through the voltage circuit; the check device of the electric energy meter supplies voltage and current signals needed for operation to the electric energy meter under test and obtains error values of the electric energy meter; and the power filter of the voltage circuit, the power filter of the current circuit and the filter of the pulse circuit respectively perform filtering processing on the voltage circuit, the current circuit and the pulse circuit so as to eliminate interference.

Owner:ZHEJIANG MEASUREMENT SCI RES INST

Method for improving anti-interference ability of rotary mechanical shaft vibration measurement system

ActiveCN101614582ASolving problems subject to severe electromagnetic interferenceImprove securitySubsonic/sonic/ultrasonic wave measurementVibration measurementElectricity

The invention provides a method for improving the anti-interference ability of a rotary mechanical shaft vibration measurement system. The method comprises the following steps: detecting the rotary mechanical shaft vibration measurement system by conducting the immunity tests on electrical fast transient / burst (EFT / B), so as to determine the part having poor anti-interference ability in the rotary mechanical shaft vibration measurement system; shielding the part having poor anti-interference ability according to the electromagnetic compatibility (EMC) principle; and detecting whether the part having poor anti-interference ability meets the requirements or not according to the immunity tests on EFT / B. The method can detect the part having poor anti-interference ability in the rotary mechanical shaft vibration measurement system on an accurate, timely and effective basis, effectively avoid the tripping operation caused by the automatic protection of the main engine of the power grid due to severe electromagnetic interference, ensure the normal operation of the main engine of the power grid, improve the safety and reliability of the power grid and avoid the huge economic loss caused by the tripping operation of the main engine due to the electromagnetic interference.

Owner:广州粤能电力科技开发有限公司

Currency dispense and control system with Anti-theft features

A cost-effective, currency dispense and control system (CDCS) securely dispenses paper money in one of the following modes: (1) an ATM system and (2) a currency control system that allows a merchant or merchant-approved employee to withdraw cash from the CDCS independent of a standard ATM electronic fund transfer (EFT) network. The CDCS may also include the following functionalities: a duress dispensation system that allows the CDCS to activate an alarm and / or otherwise communicate with local police or security services during a robbery, a time-release system that effects a time-delayed dispensation functionality, and a user identification and authentication system for authenticating a user identity and determining eligibility of the user to access the currency control system.

Owner:PEREGRIN TECH

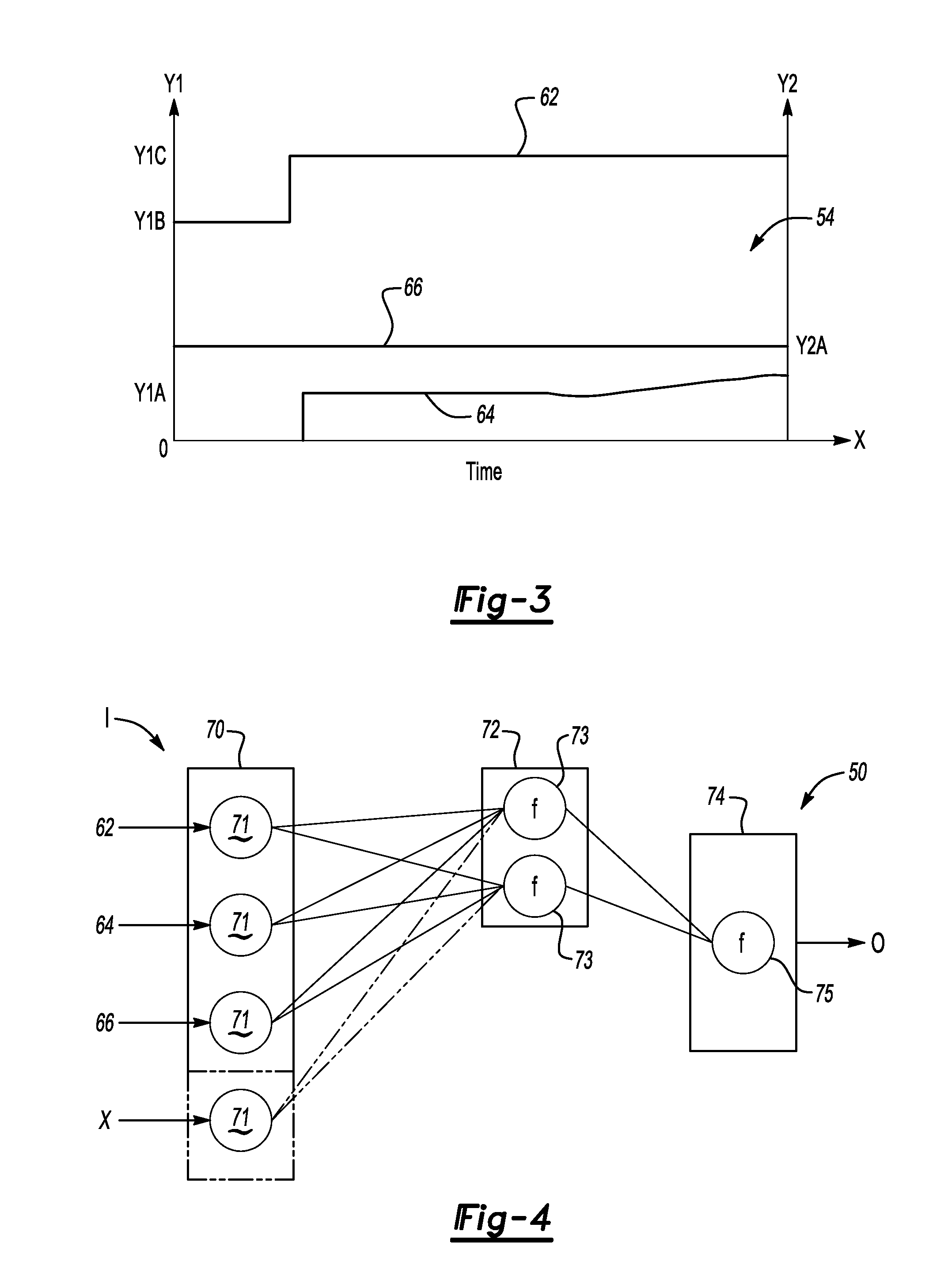

System and method for controlling a clutch fill event

A method optimizes a fill event of an apply chamber of a fluid-actuated clutch, and includes determining input values describing the fill event, and then estimating a fill time using the input values. The method includes filling the apply chamber using the estimated fill time (EFT) or within an allowable range of the EFT. The input values can include a command line pressure, command fill stroke pressure, and an estimated viscosity of the fluid, although other values can be used. The input values are processed through a neural network having an input layer, an optional hidden layer, and an output layer. An assembly includes a fluid-actuated clutch having an apply chamber and a controller operable for estimating the fill time required for filling the apply chamber, and for controlling the fill of the apply chamber within the EFT.

Owner:GM GLOBAL TECH OPERATIONS LLC

System and Method for Controlling a Clutch Fill Event

InactiveUS20100018833A1Digital data processing detailsFluid actuated clutchesHidden layerEngineering

A method optimizes a fill event of an apply chamber of a fluid-actuated clutch, and includes determining input values describing the fill event, and then estimating a fill time using the input values. The method includes filling the apply chamber using the estimated fill time (EFT) or within an allowable range of the EFT. The input values can include a command line pressure, command fill stroke pressure, and an estimated viscosity of the fluid, although other values can be used. The input values are processed through a neural network having an input layer, an optional hidden layer, and an output layer. An assembly includes a fluid-actuated clutch having an apply chamber and a controller operable for estimating the fill time required for filling the apply chamber, and for controlling the fill of the apply chamber within the EFT.

Owner:GM GLOBAL TECH OPERATIONS LLC

Early-payment discount for e-billing system

InactiveUS20100332309A1Reduces the enterprises “Days Receivable OutstandingComplete banking machinesDiscounts/incentivesInvoiceEFTS

An Early Payment Discount (EPD) mechanism that enables customers to automatically receive an early payment discount for paying their invoice electronically, e.g., via electronic funds transfer (EFT), through an e-Billing system within a designated number of days from on-line invoice post date.

Owner:RAKUTEN INC

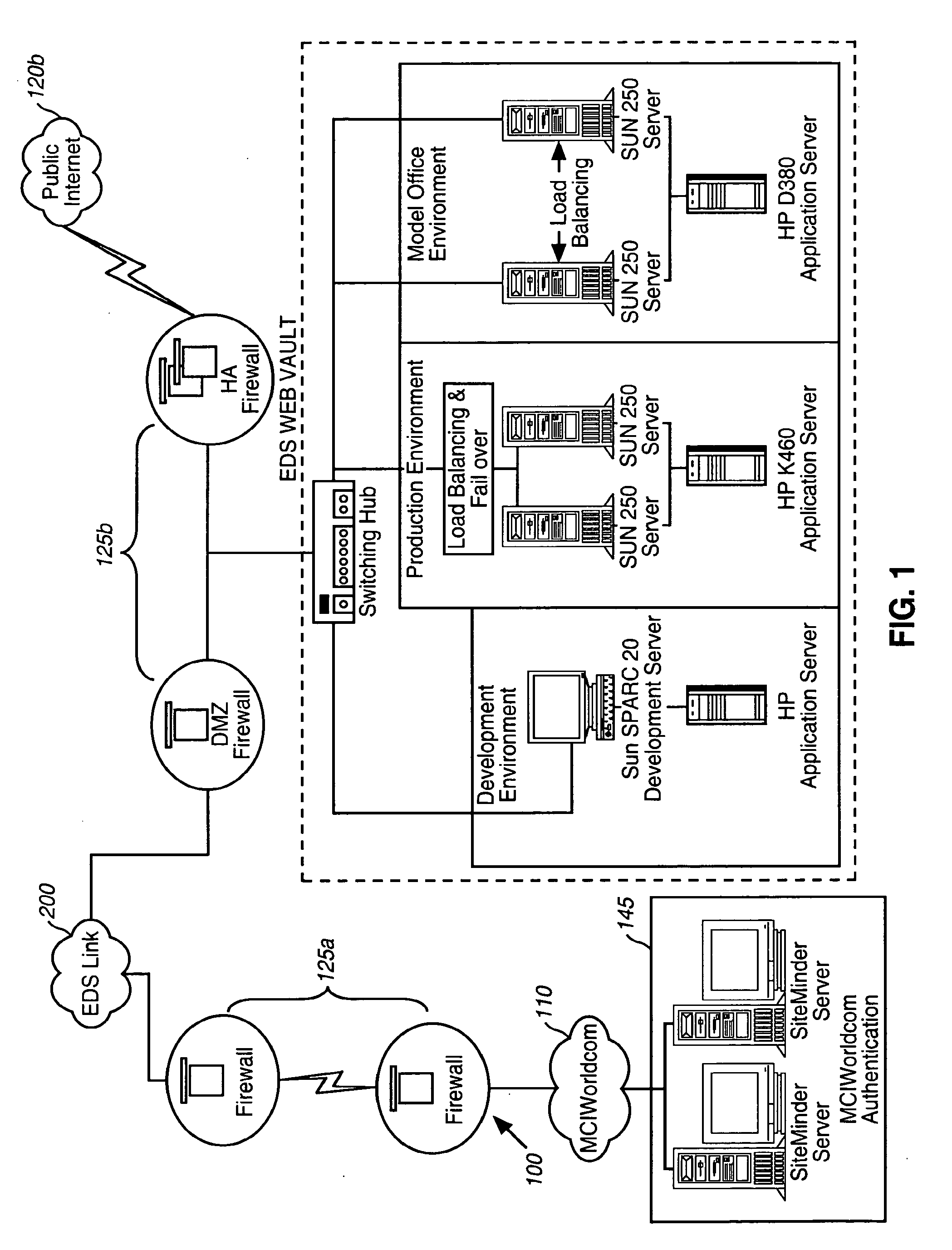

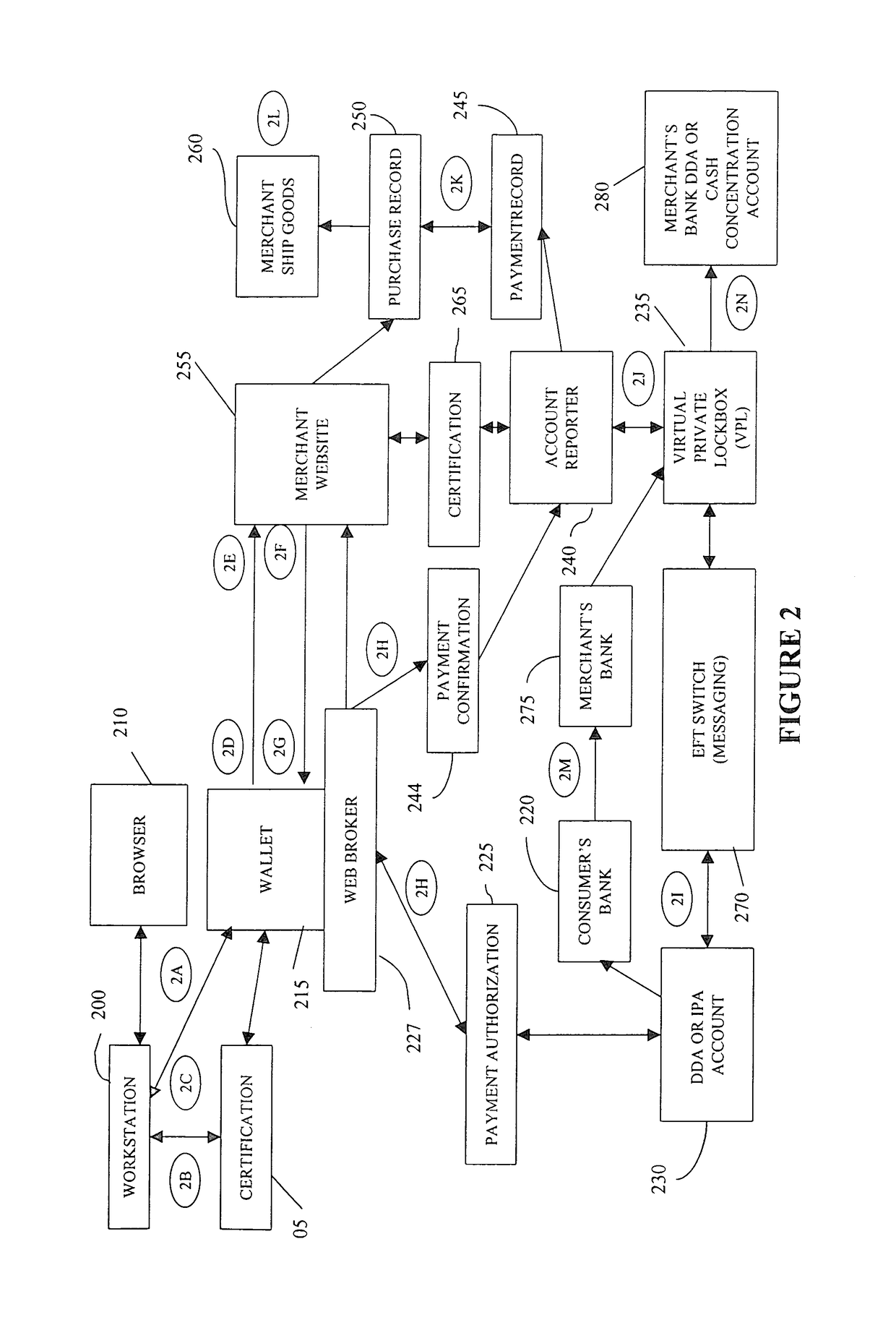

Method and system for processing internet payments

ActiveUS10185936B2Safe, sound, and secureFinancePayment circuitsApplication softwareInternet shopping

A system and method for effectuating Electronic Funds Transfer credit messages. The main structural components of the system include a Payment Portal Processor (Web Broker), an Internet Pay Anyone (IPA) Account, a Virtual Private Lockbox (VPL) and an associated Account Reporter, the existing EFT networks, and a cash card for accessing a VPL or IP account. The Web Broker is a software application that provides a secure portal for accessing (linking to) either the user's Demand Deposit Account (DDA) or an IPA account and can be combined with the functionality of a traditional digital Wallet. Consumers use a Web Broker enhanced Wallet to fund their account, shop on the web, pay bills, pay anyone, store electronic receipts and transaction history, and check their recent Web Broker enhanced Wallet activity. The IPA account is a special purpose account with limited functionality for making electronic payments in the form of EFT credit messages. The VPL is a limited function receive only account for receiving electronic payments through the EFT. The Account Reporter is a portal to view transaction history and balance of IPA and VPL accounts, provide online, real-time transaction reports, and to reconciles accounts receivable / purchase records against incoming EFT payment records. A physical card can be associated with either an IPA or VPL account in order to provide PIN debit capability.

Owner:JPMORGAN CHASE BANK NA

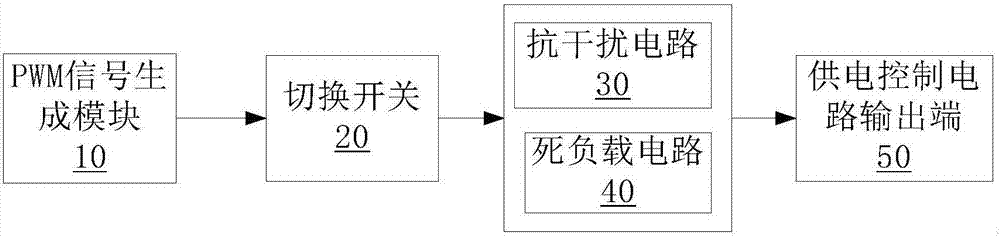

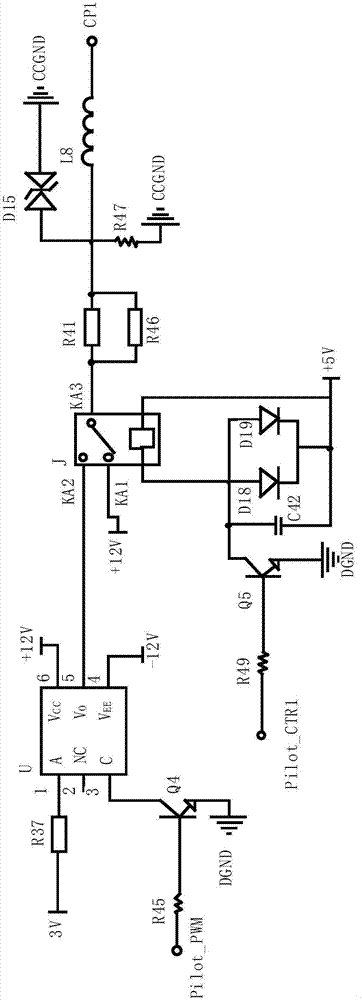

Power supply control circuit, electromobile charging guide circuit and charging pile

ActiveCN106936183AIncrease discharge interference voltageImprove immunityCharging stationsElectric powerLoad circuitDisturbance voltage

The invention relates to a power supply control circuit applied to an electromobile charging guide circuit. The power supply control circuit comprises a pulse width modulation (PWM) signal generation module, a power supply control circuit output end and a switch, wherein the switch is arranged between the PWM signal generation module and the power supply control circuit output end, and an anti-interference circuit and a dead load circuit are arranged at the power supply control circuit output end. The invention also proposes the electromobile charging guide circuit and a charging pile. A dead load is additionally arranged at the power supply control circuit output end, and thus, the anti-interference performance is improved; and a magnetic bead is additionally arranged, a discharge interference voltage of a diode is suppressed in a bidirectional transient way, and the electrical fast transient (EFT) capability and the electro-static discharge (ESD) capability of the power supply control circuit are improved.

Owner:NIO CO LTD

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com