Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

134 results about "Wire transfer" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

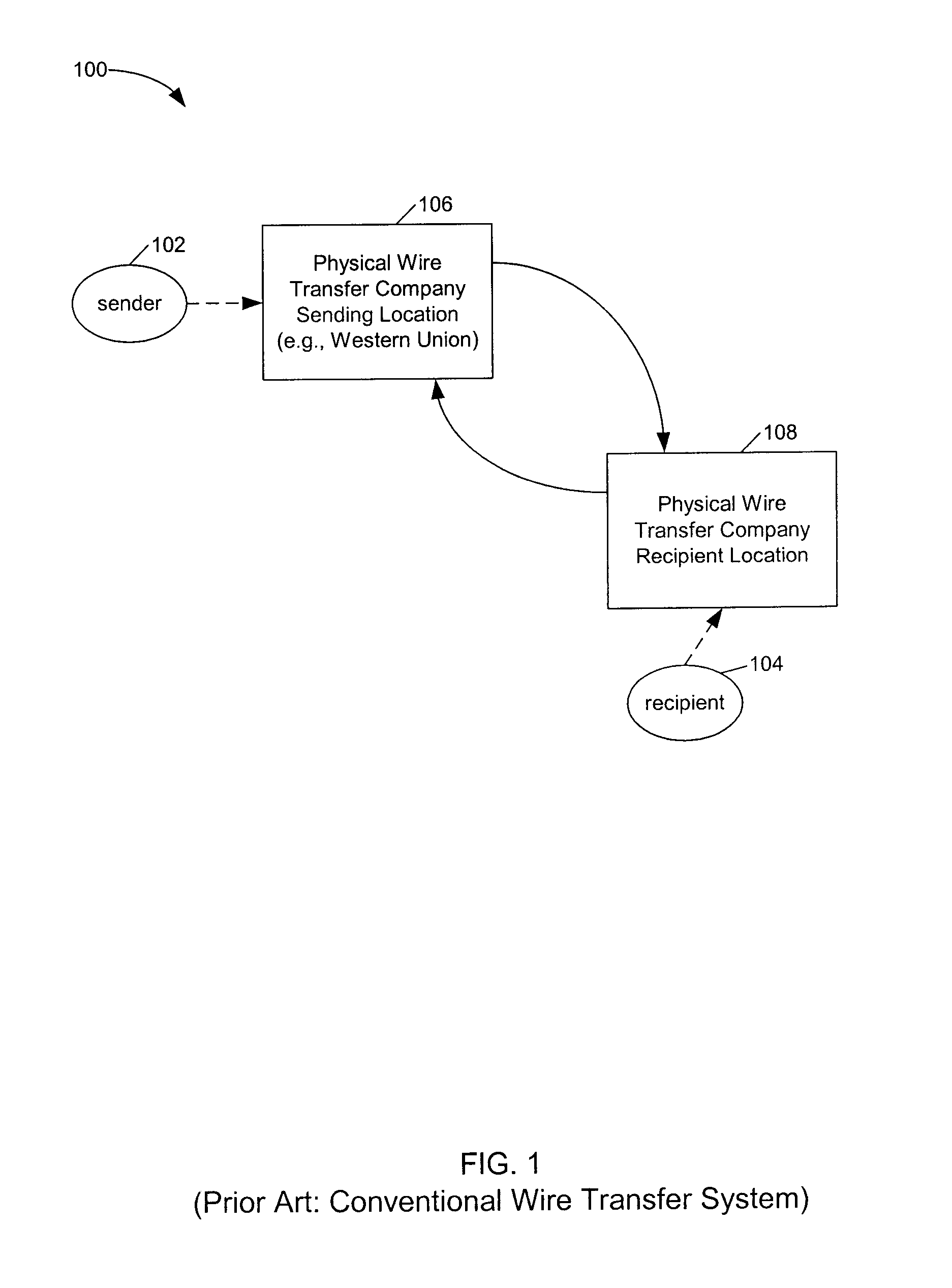

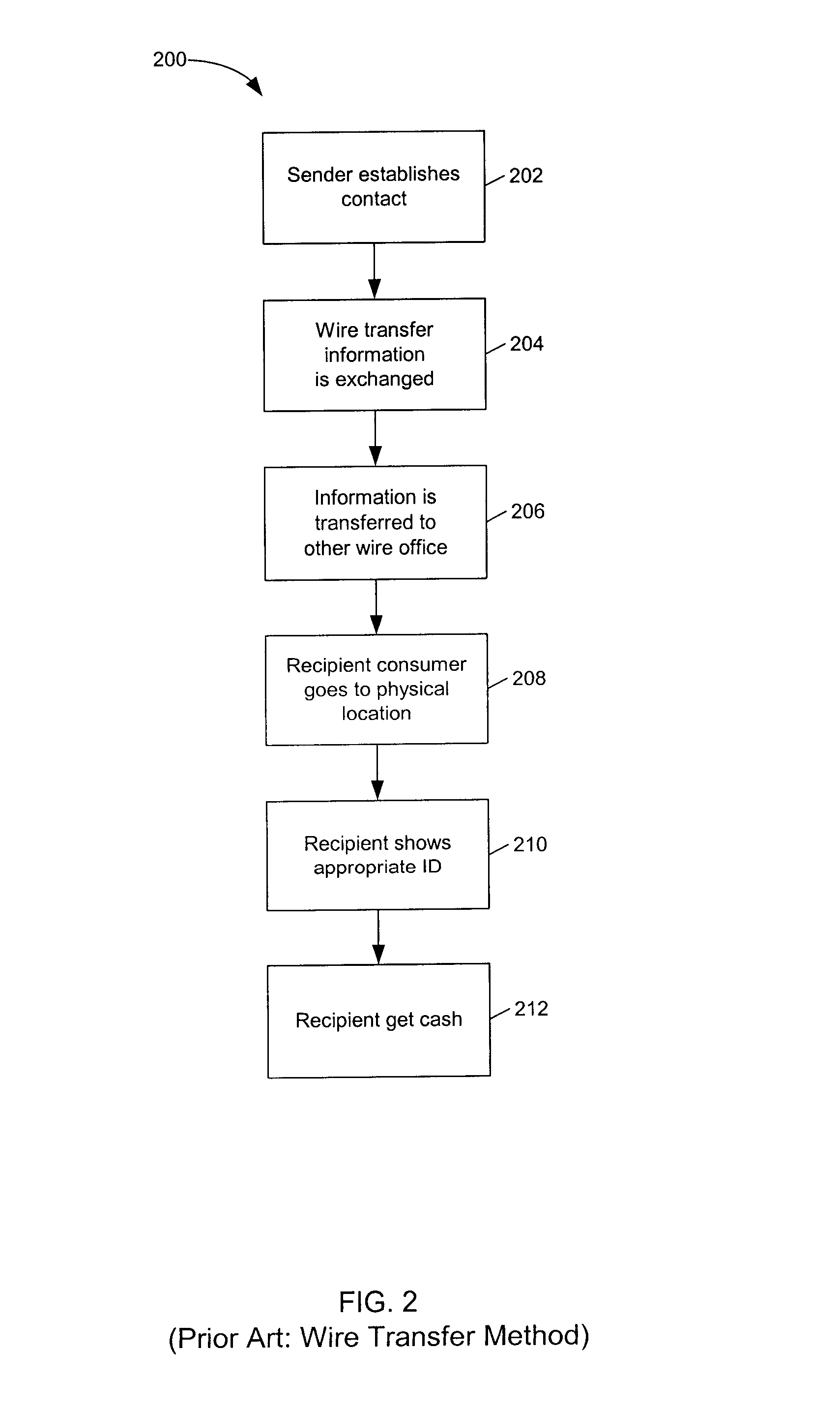

Wire transfer, bank transfer or credit transfer, is a method of electronic funds transfer from one person or entity to another. A wire transfer can be made from one bank account to another bank account or through a transfer of cash at a cash office.

Method and system for transferring electronic funds

InactiveUS7644037B1Promote commercial linkQuick applicationComplete banking machinesFinanceCredit cardThe Internet

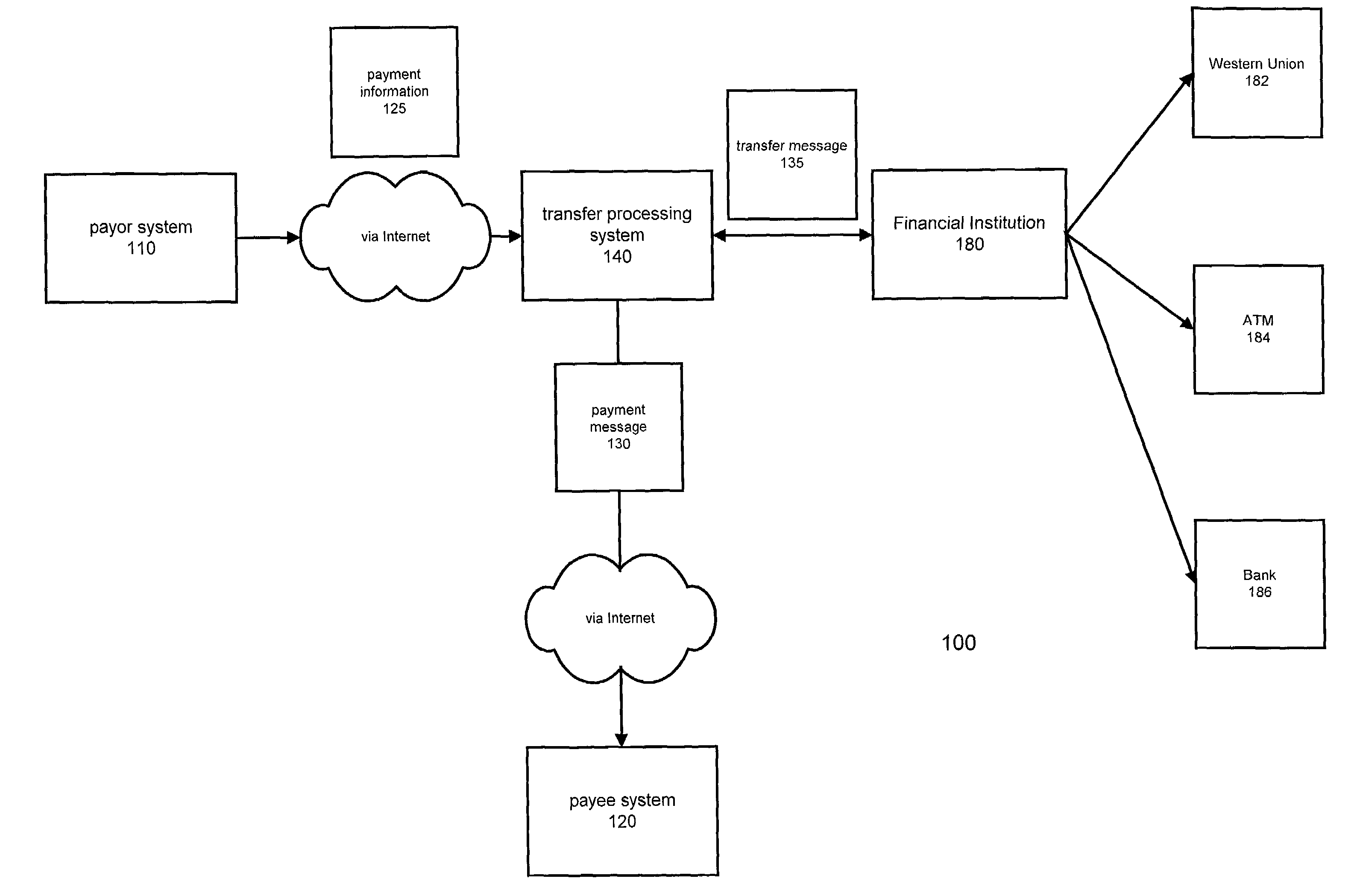

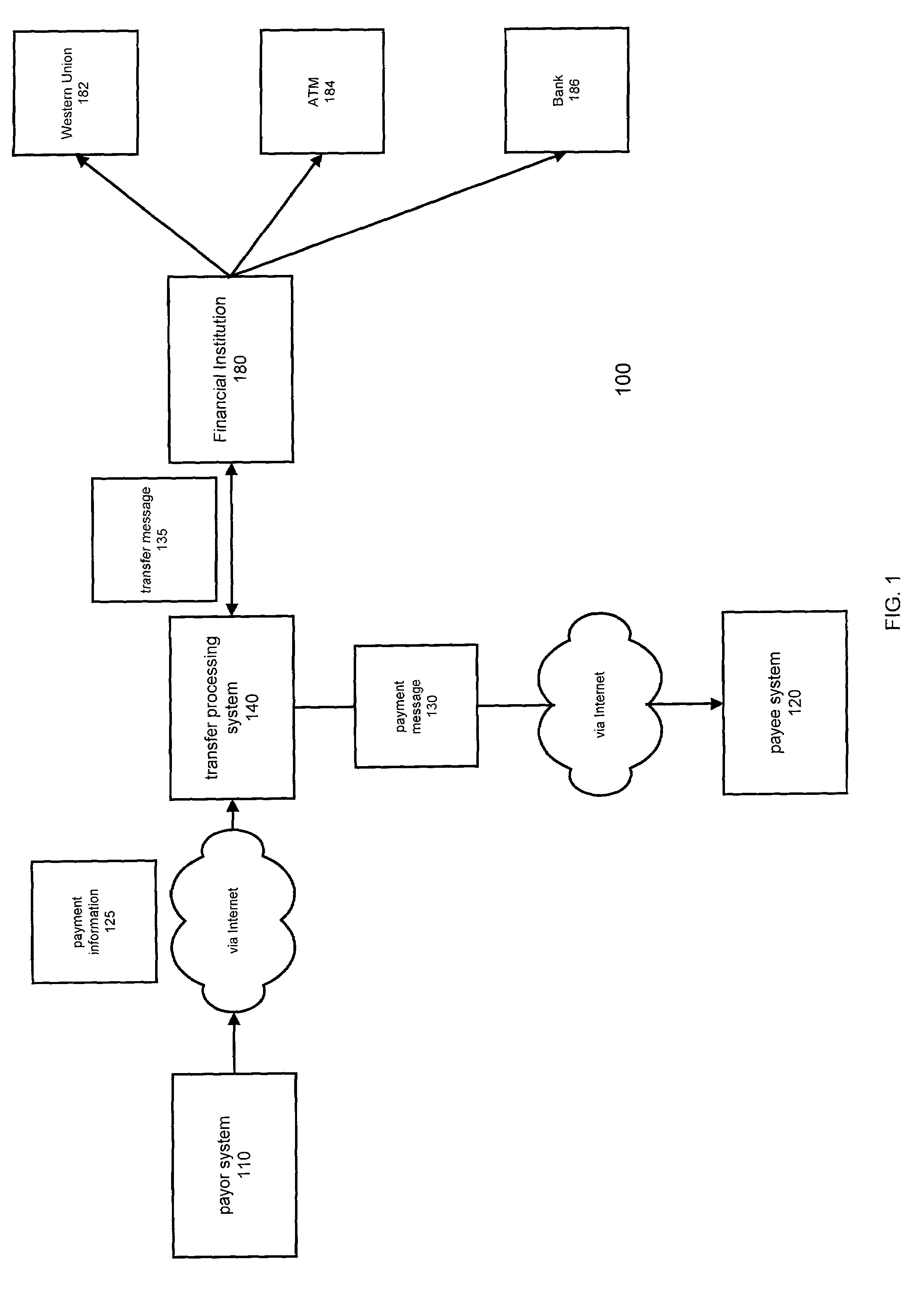

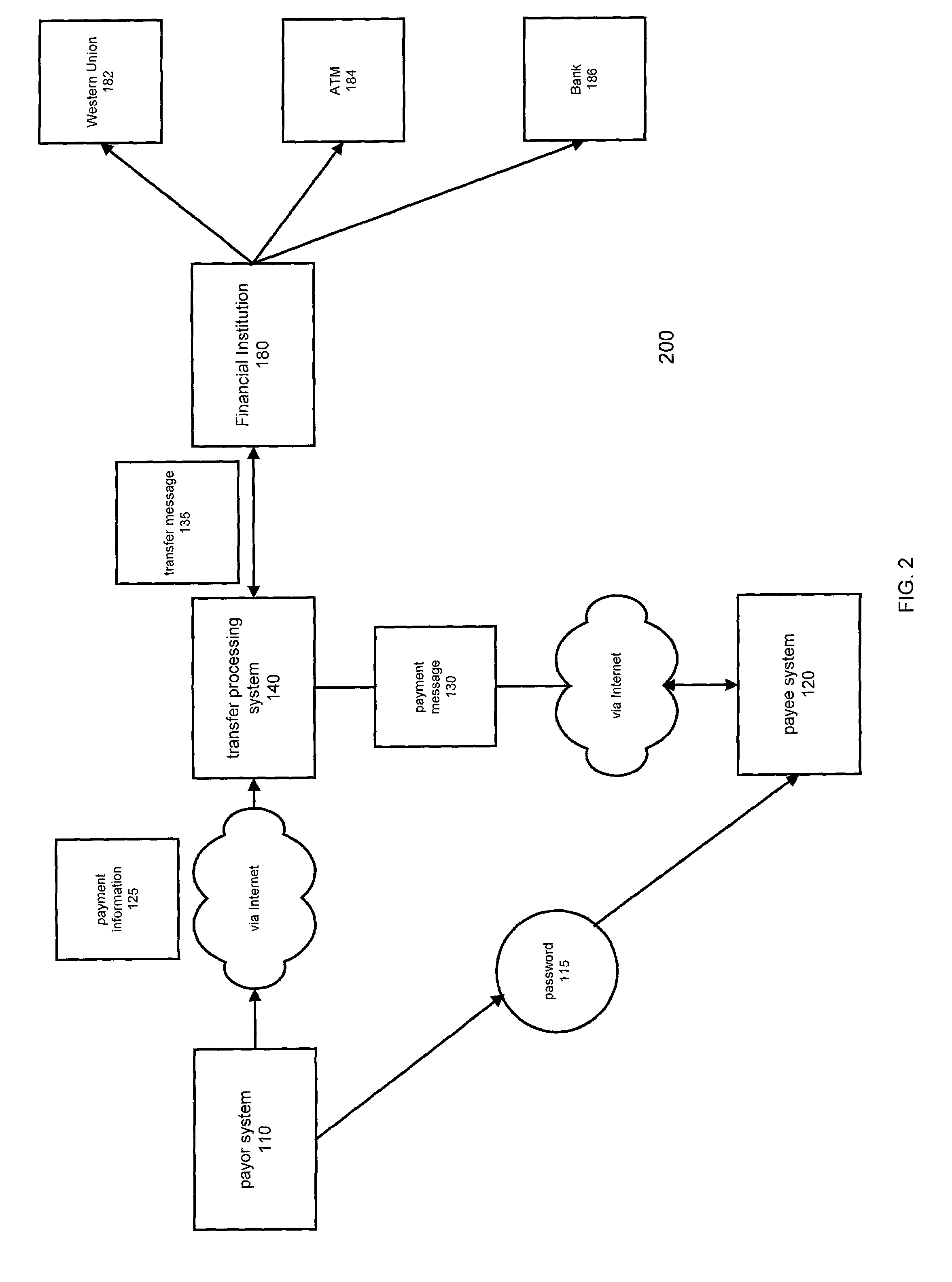

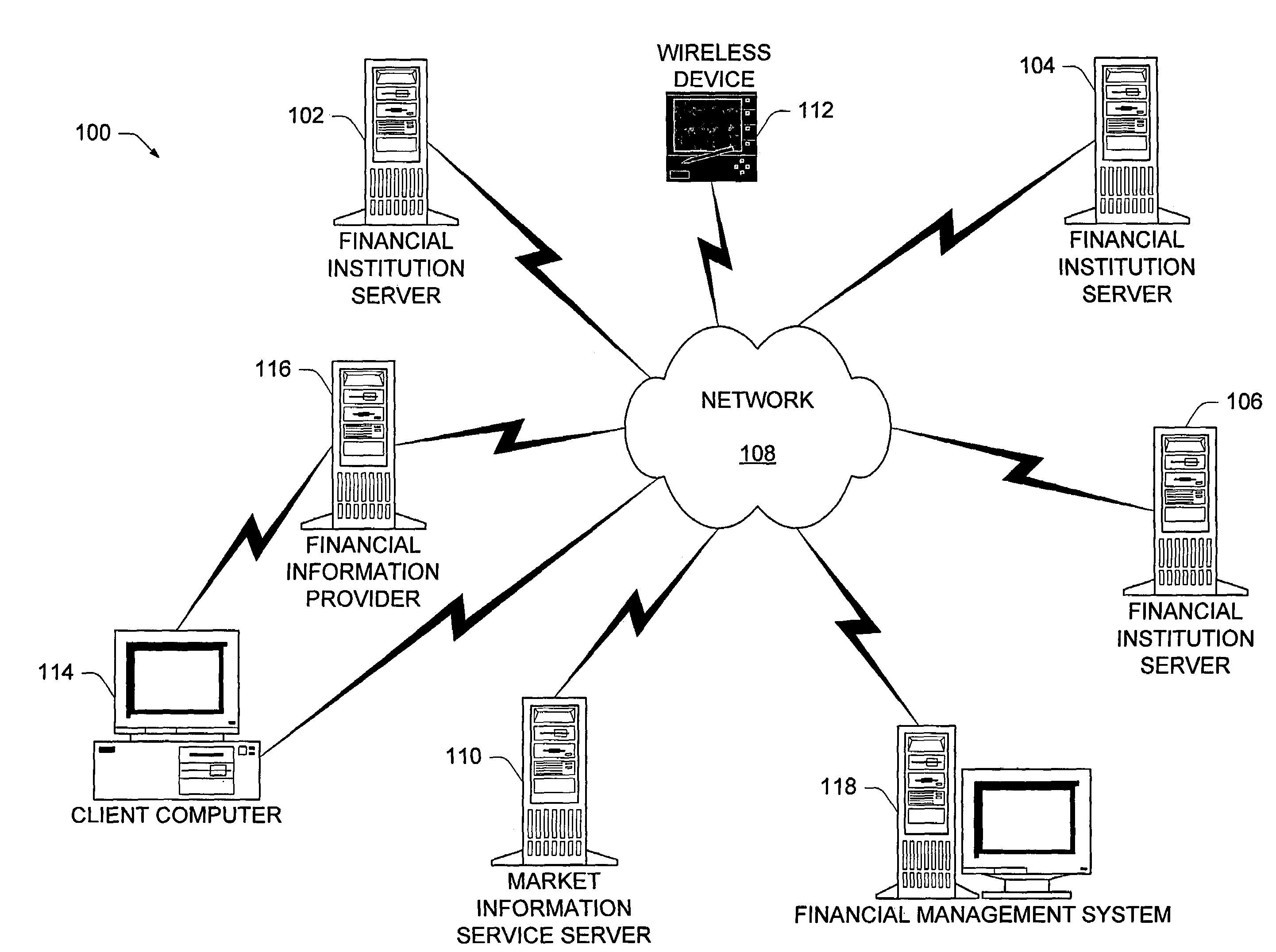

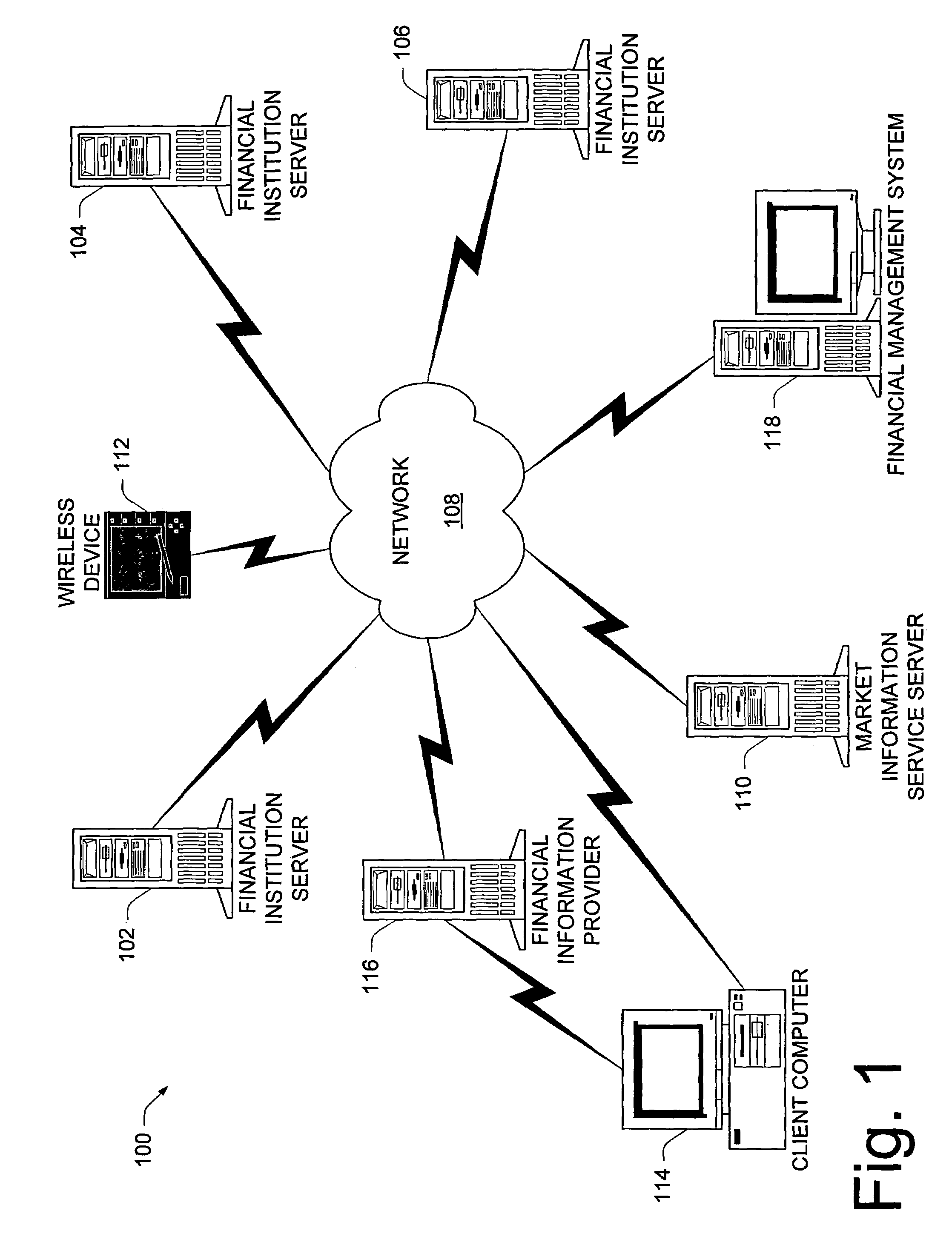

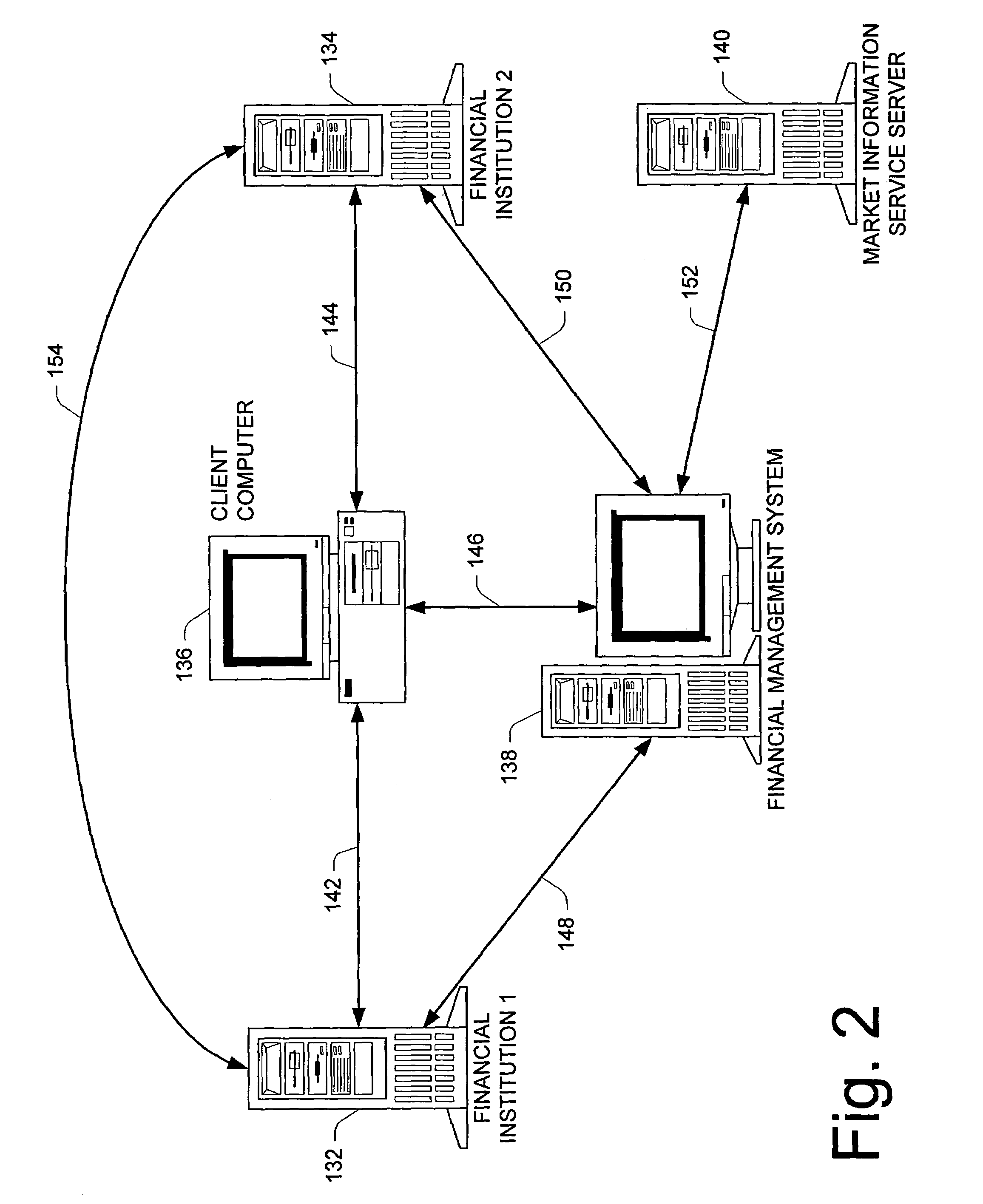

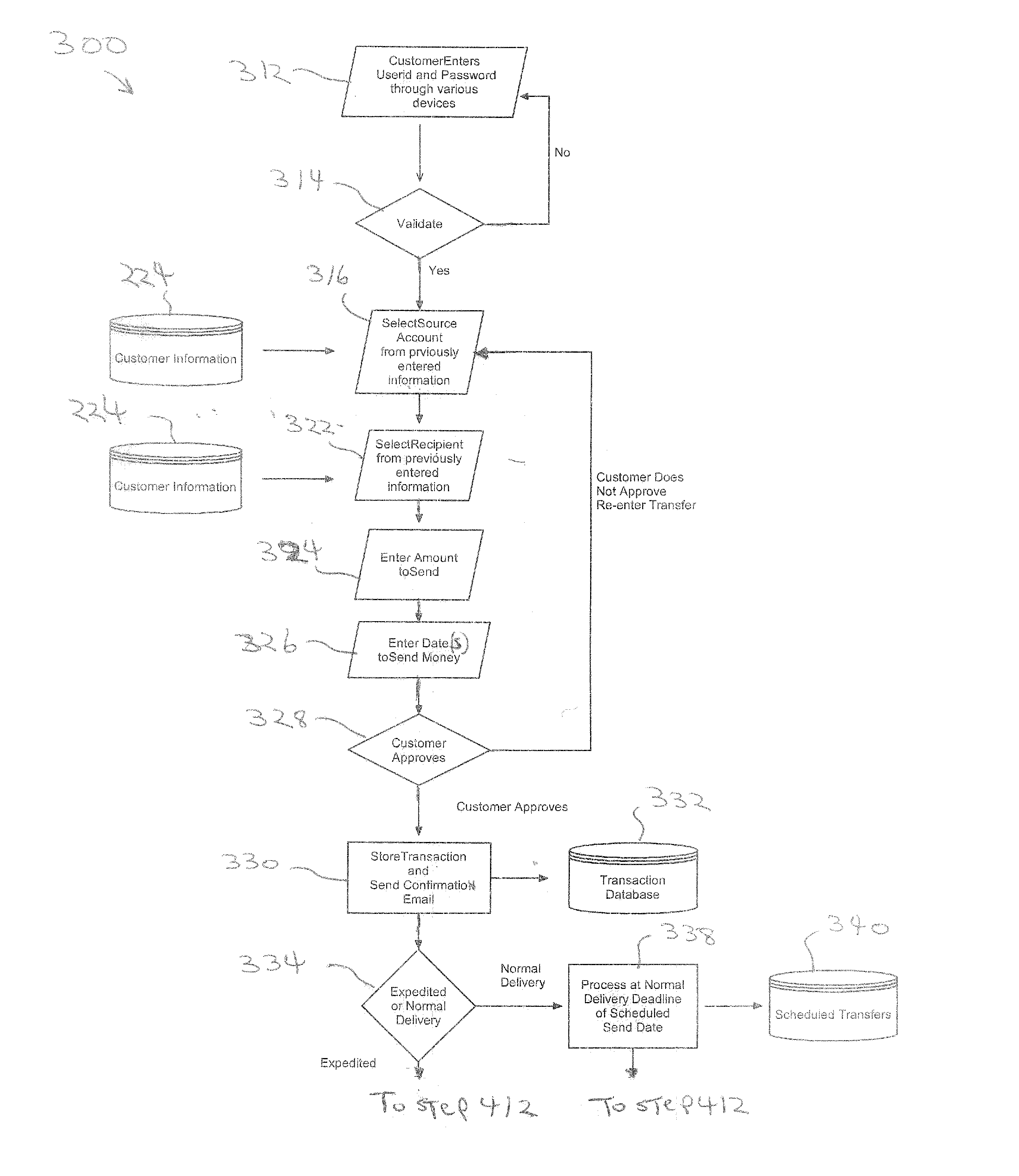

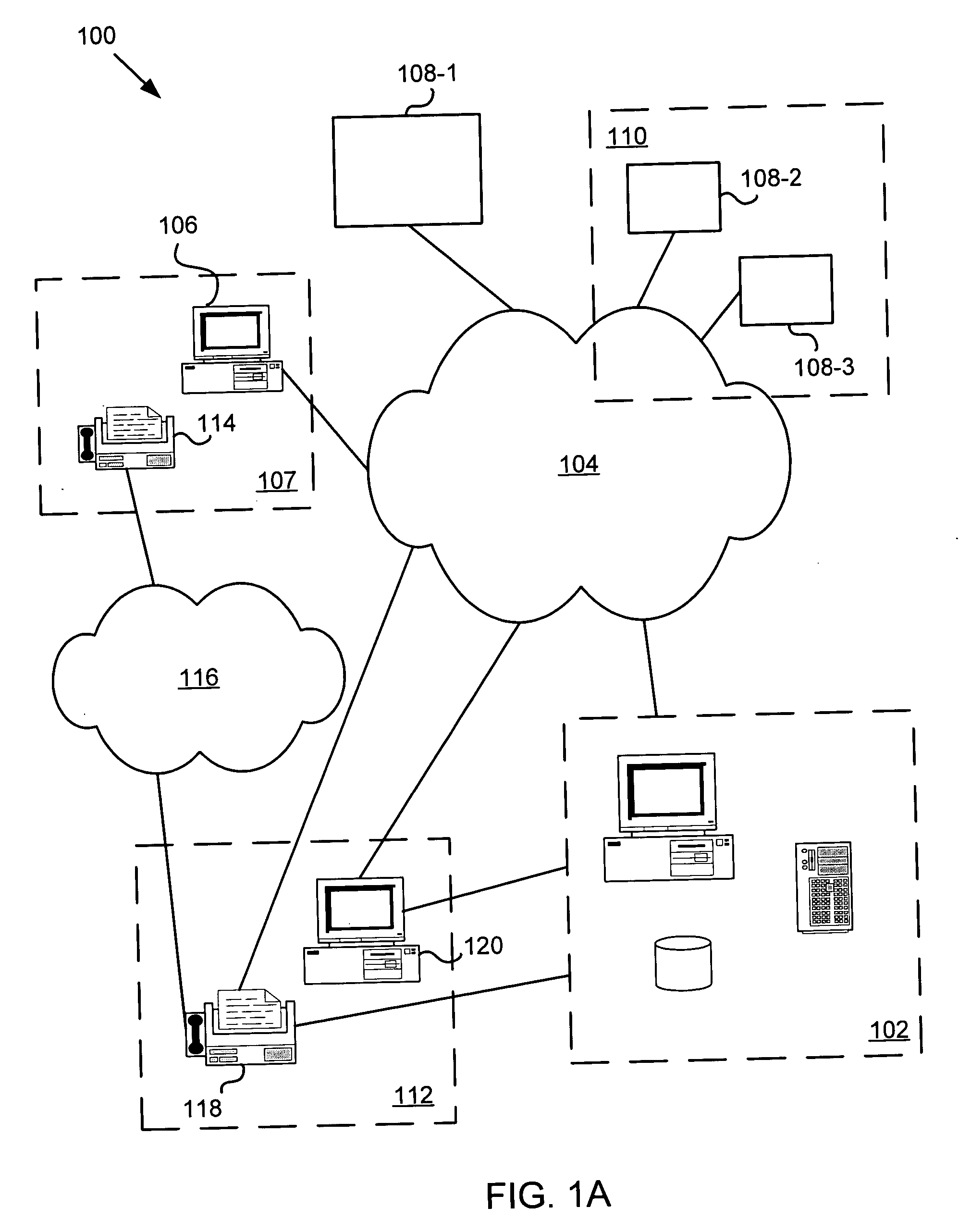

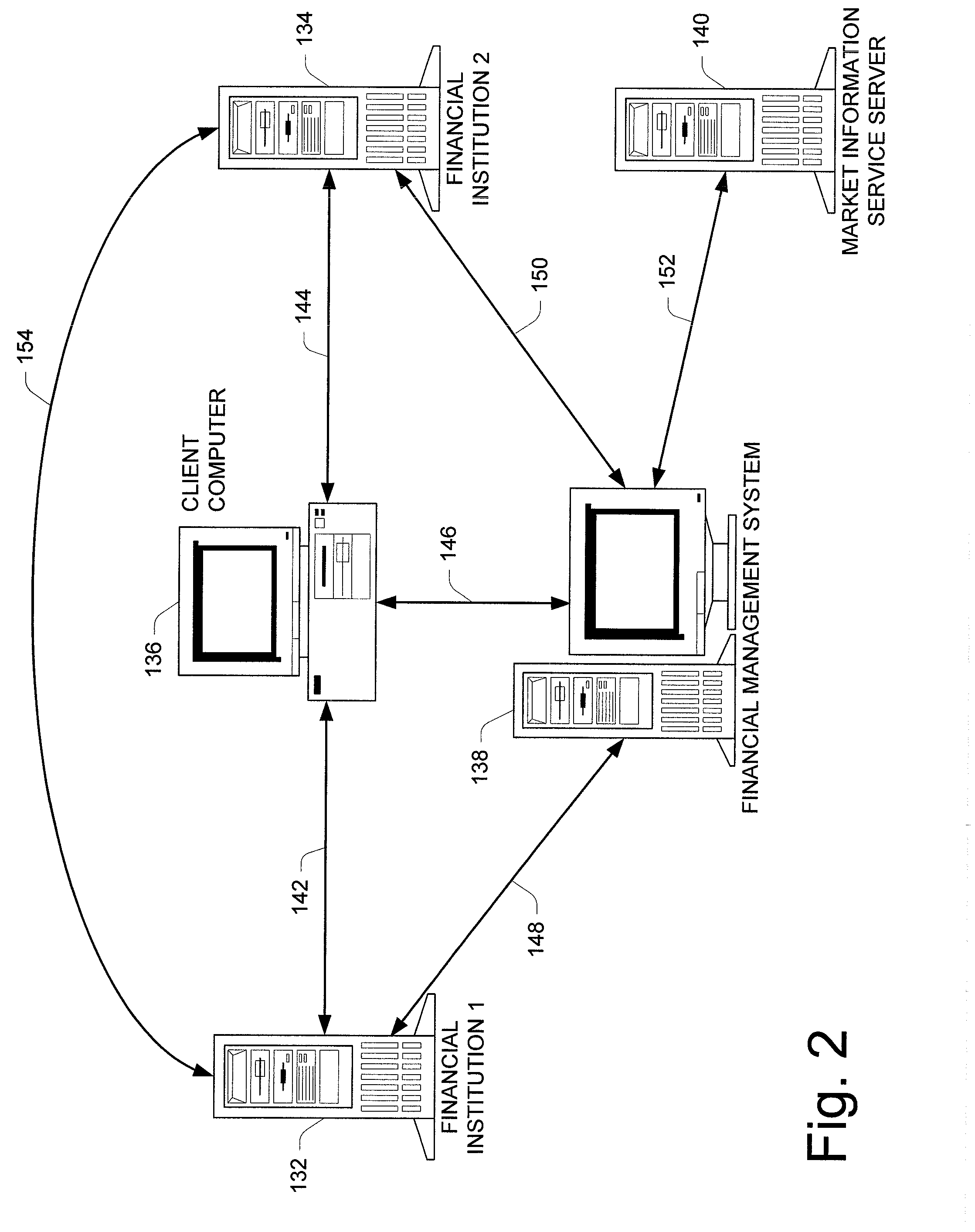

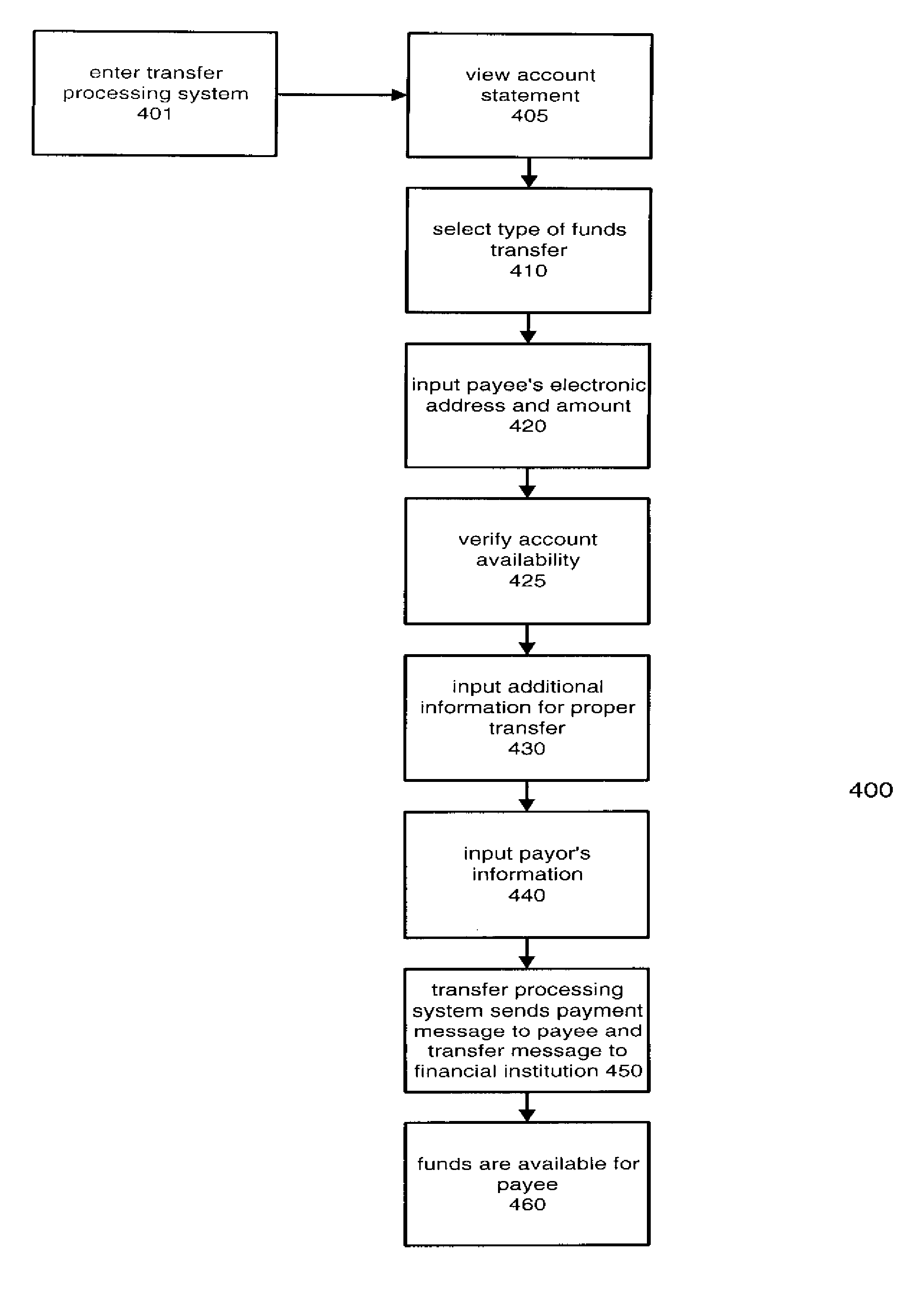

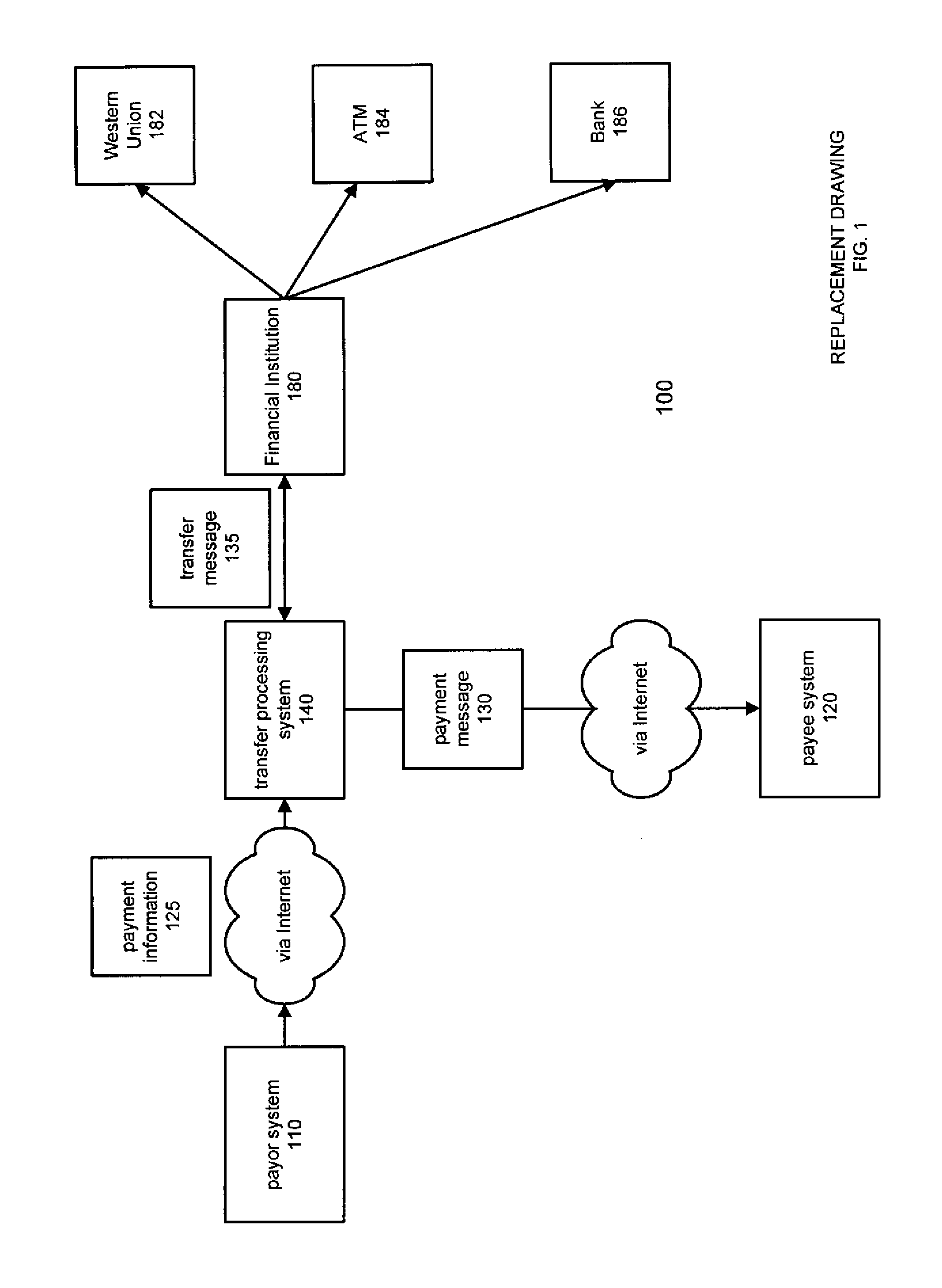

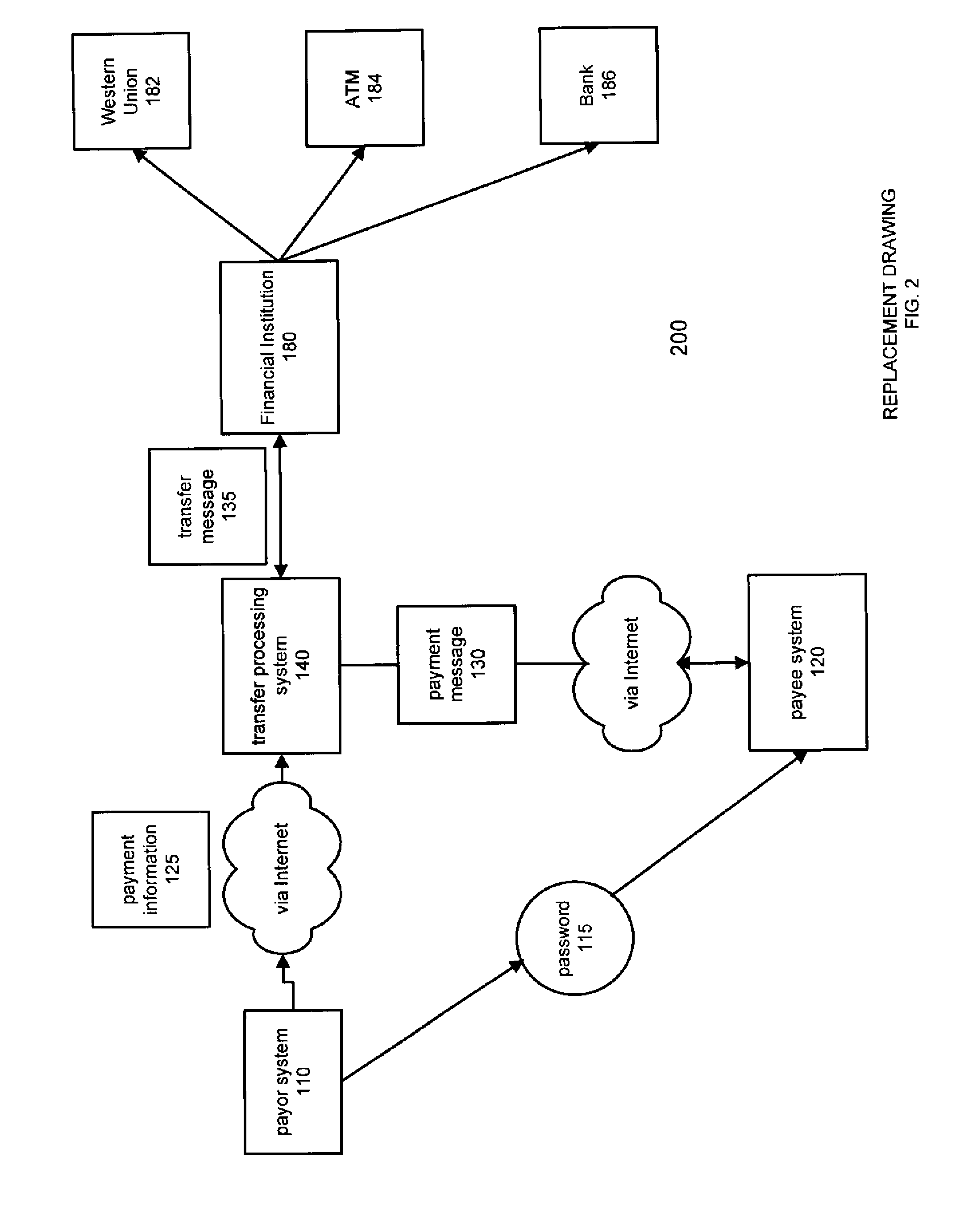

A method and system for transferring electronic funds over the Internet wherein a sender provides payment information to a transfer processing system. The sender may choose from a plurality of different types of funds transfer, such as wire transfer, Western Union money transfer, various types of checks, and transfers to ATM debit / credit cards. The transfer processing system sends an electronic payment message to a recipient indicating the transfer of funds and a transfer message to a financial institution providing instructions to debit the sender's account and make those funds available to the recipient. If the recipient has an account with a financial institution that is affiliated with the transfer processing system of the present invention, the funds are credited to the recipient's account wherein the payment message serves as a confirmation message. If the recipient does not have such an account, the recipient may access the transfer processing system to access the funds made available by the system wherein the payment message serves as a payment availability message.

Owner:BLACKBIRD TECH

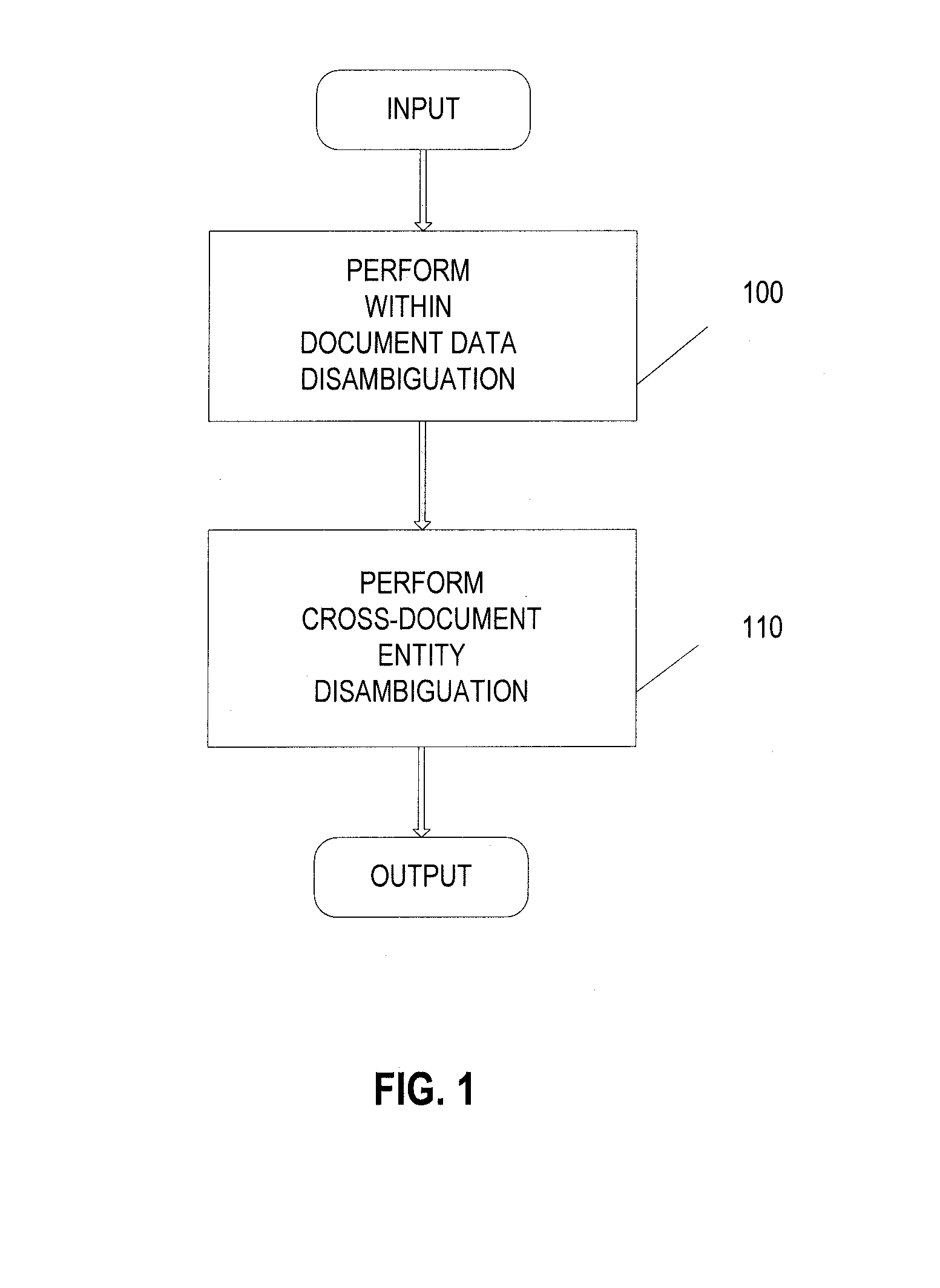

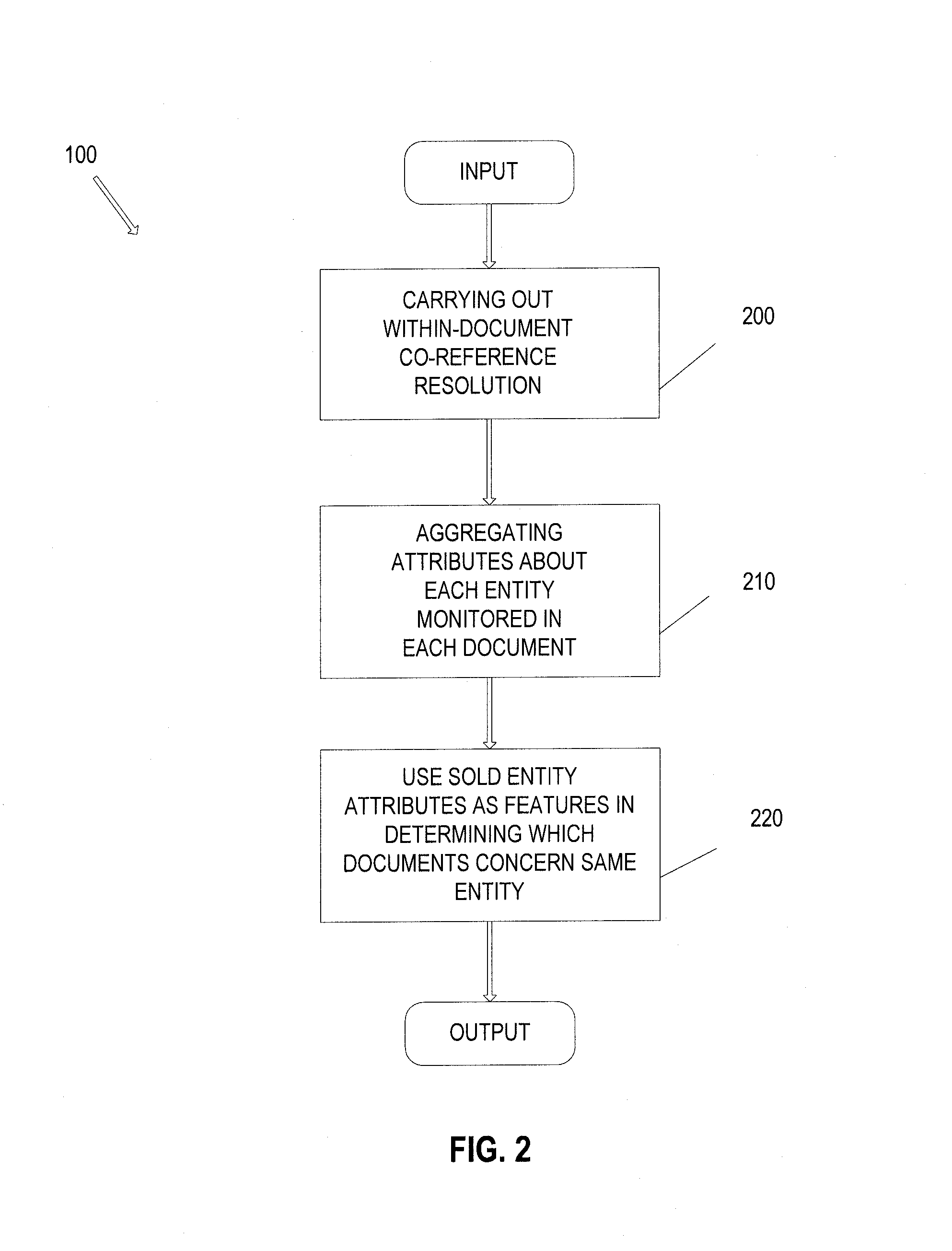

Method and apparatus for automatic entity disambiguation

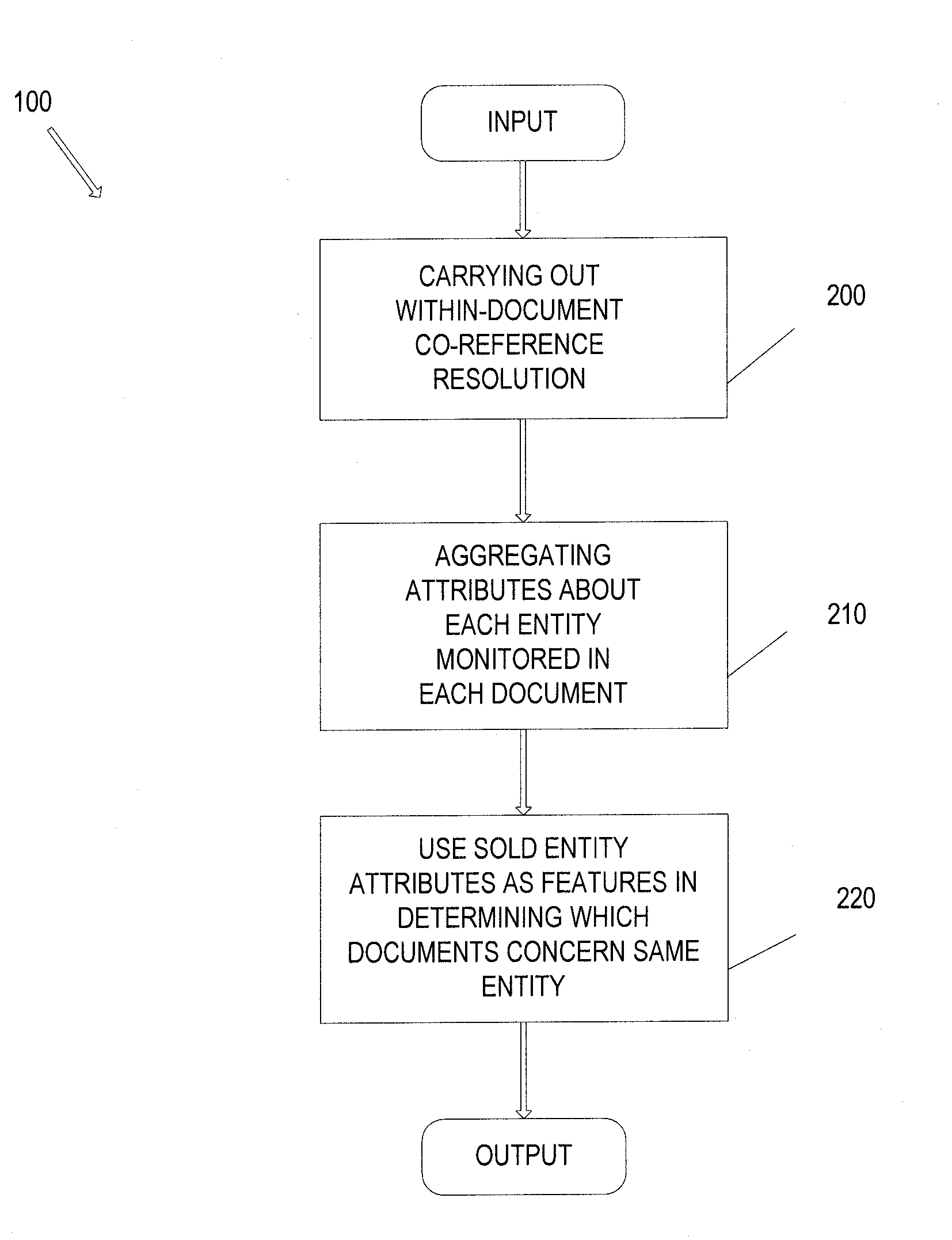

ActiveUS7672833B2Efficiently findImprove throughputNatural language data processingOffice automationSemi-structured dataWeight of evidence

Owner:FAIR ISAAC & CO INC

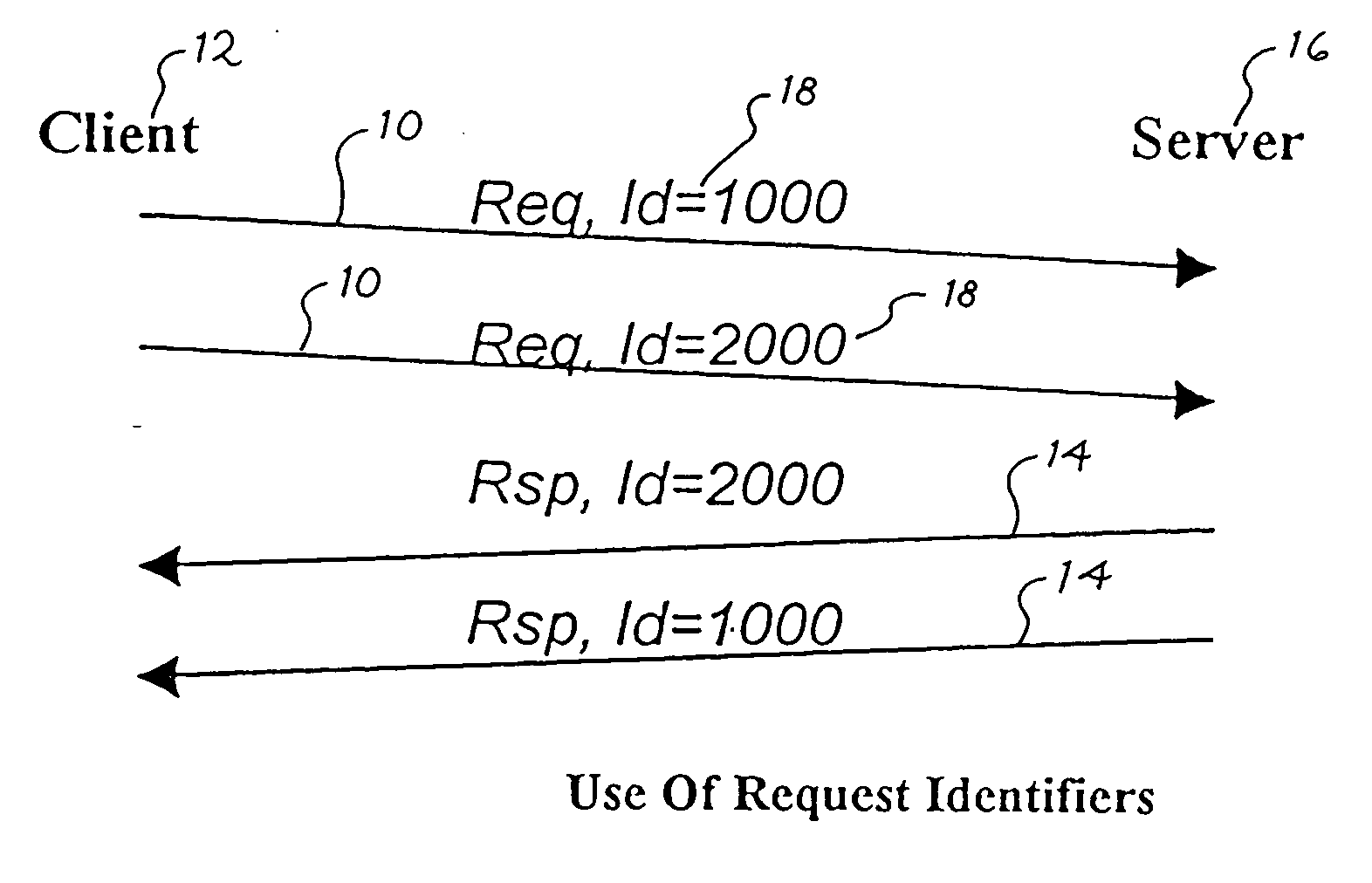

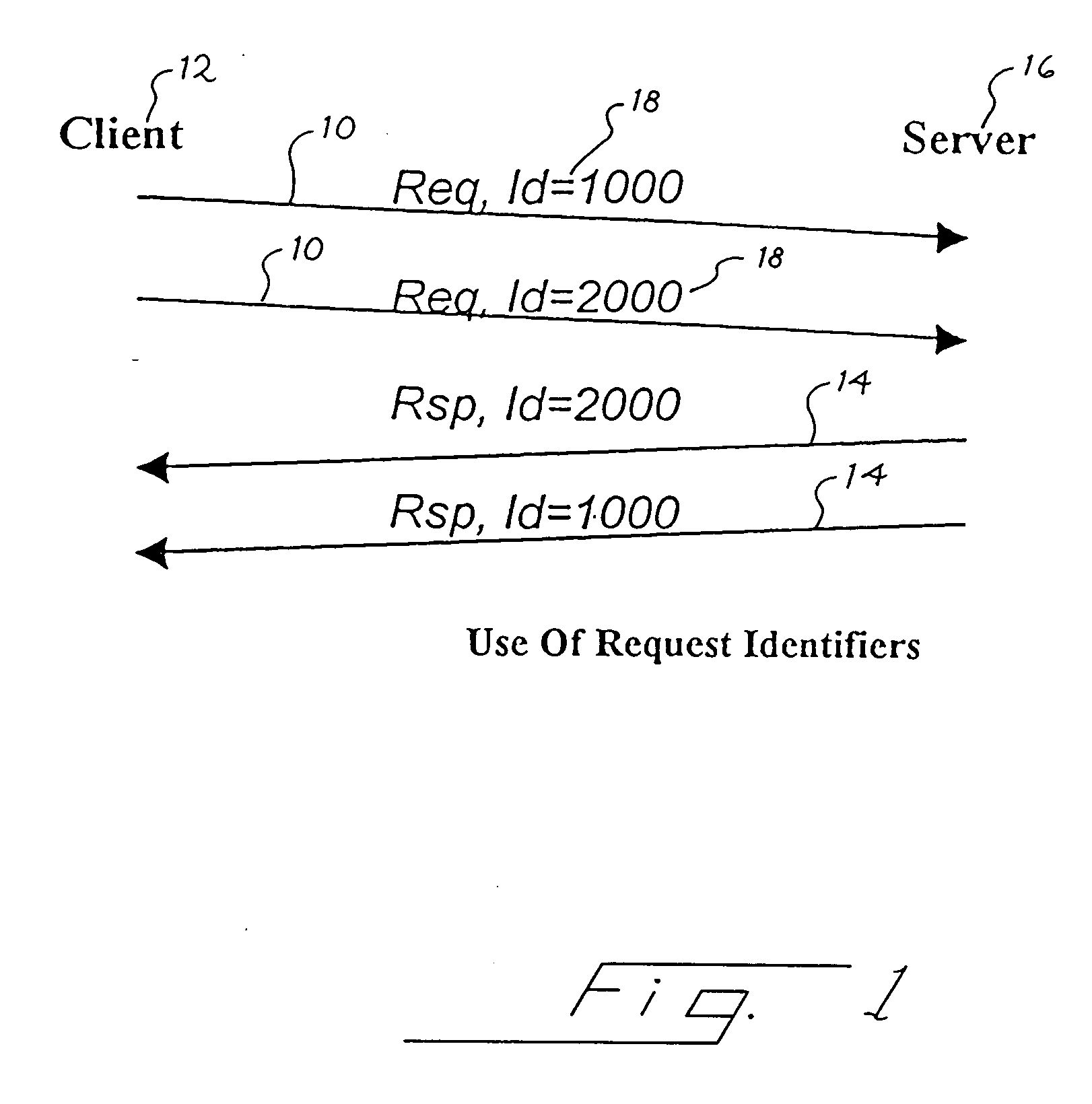

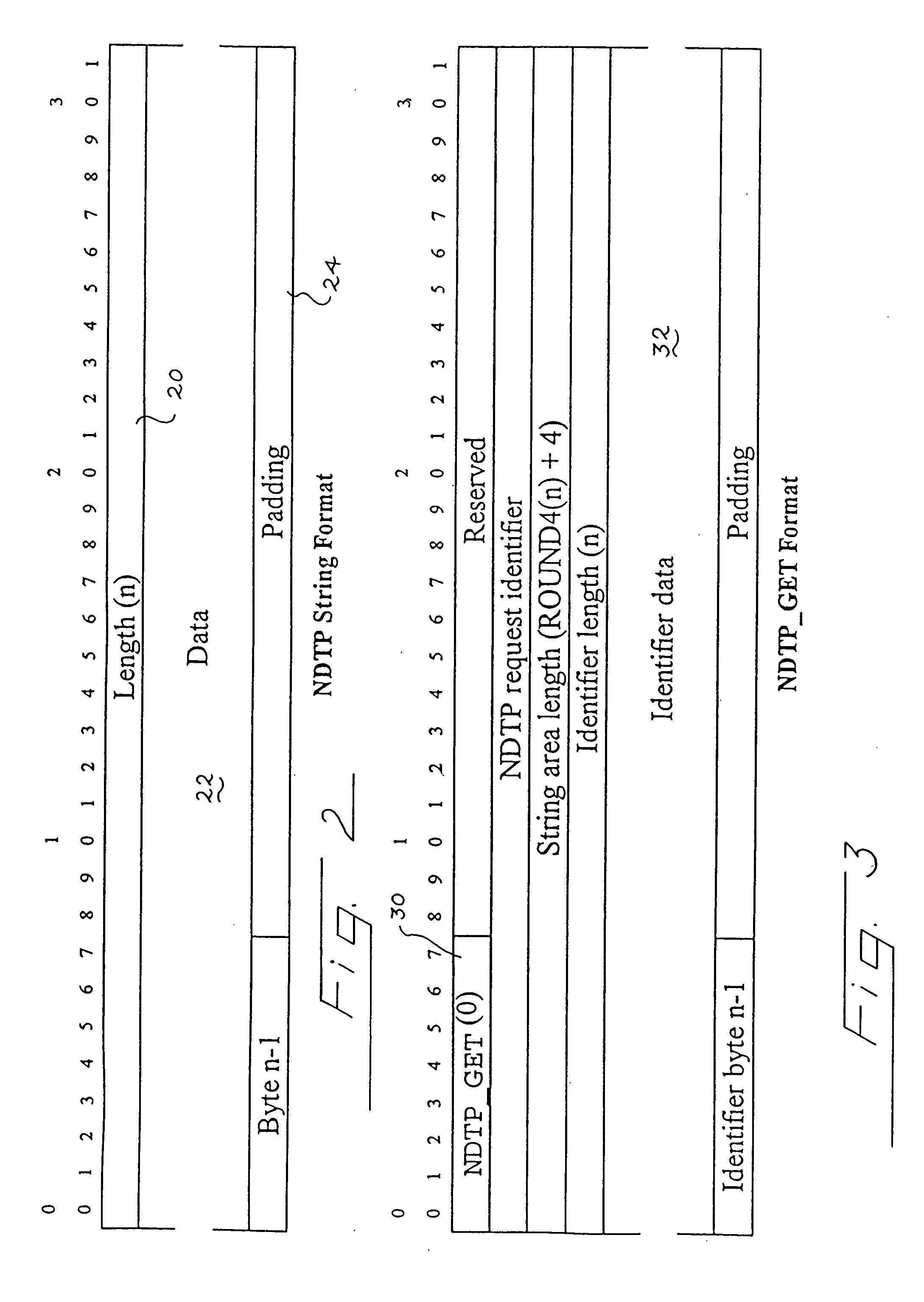

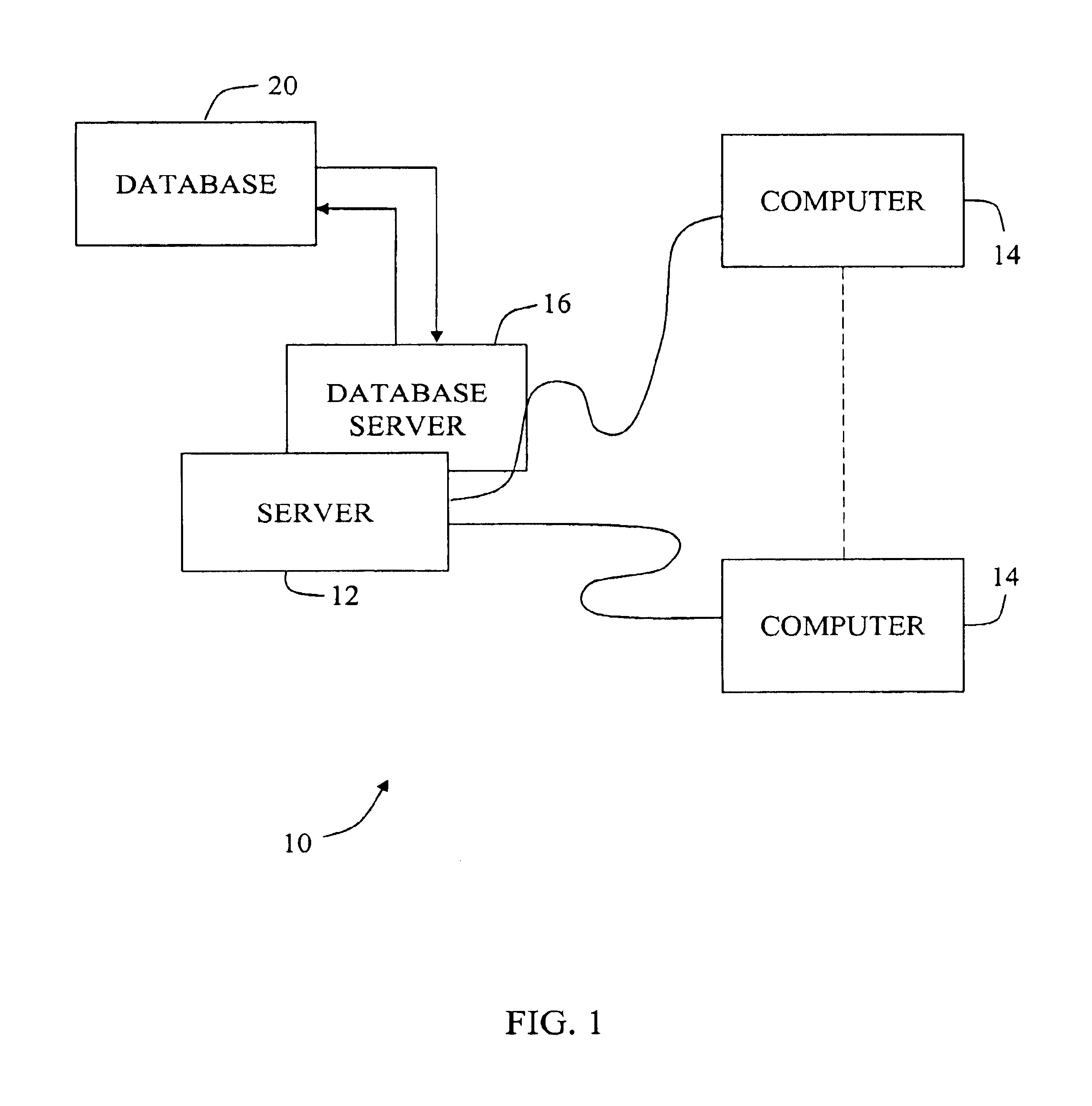

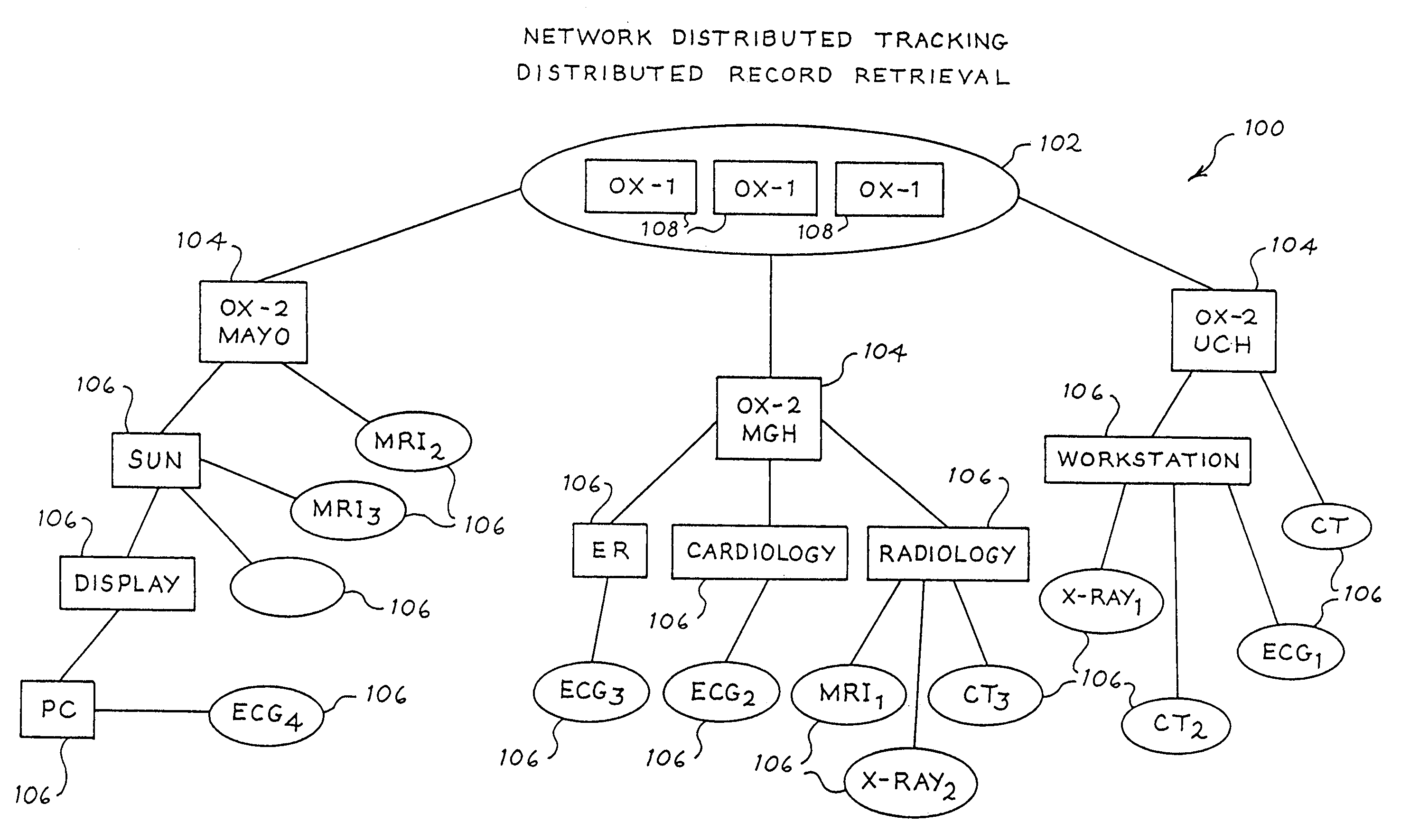

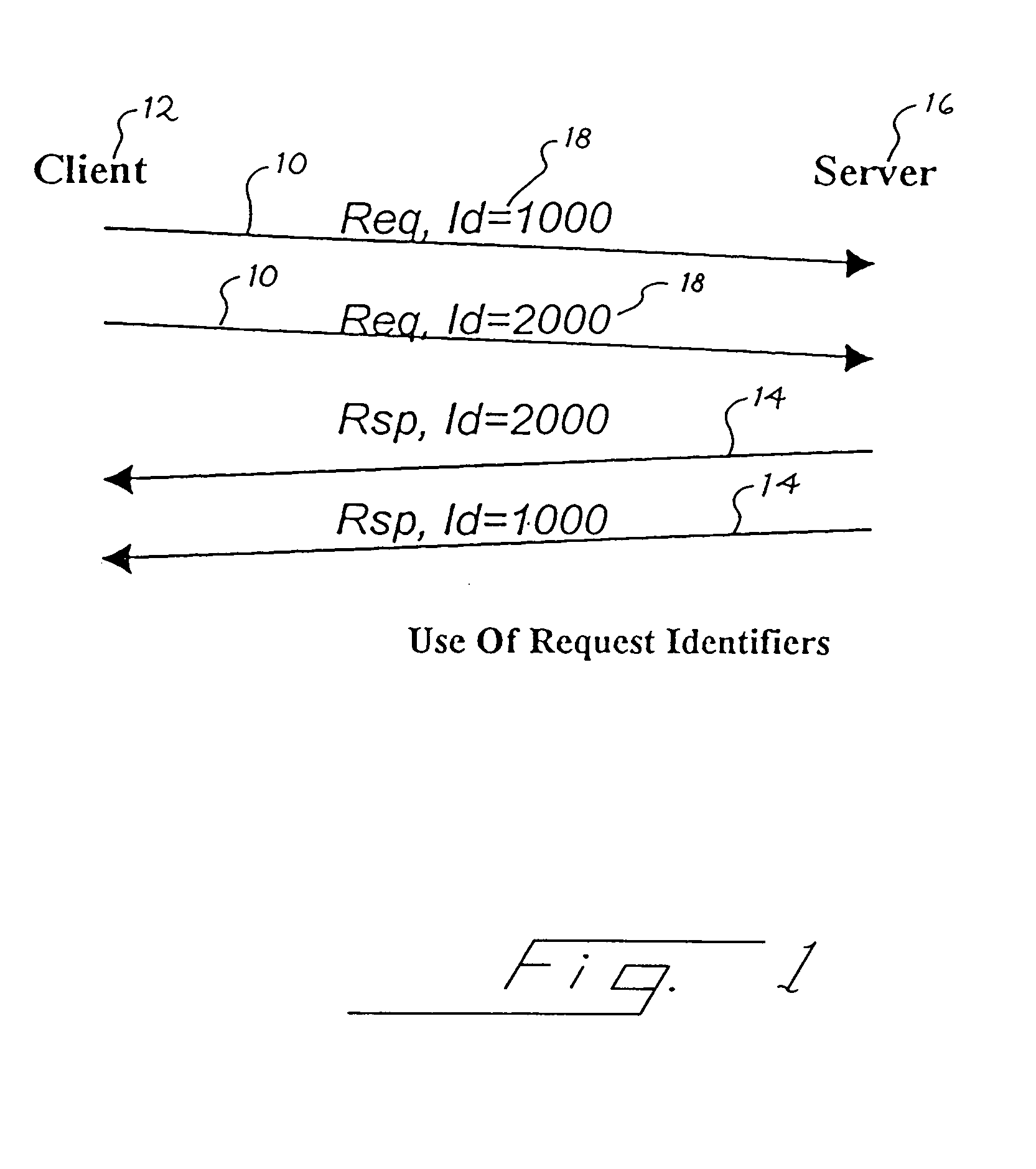

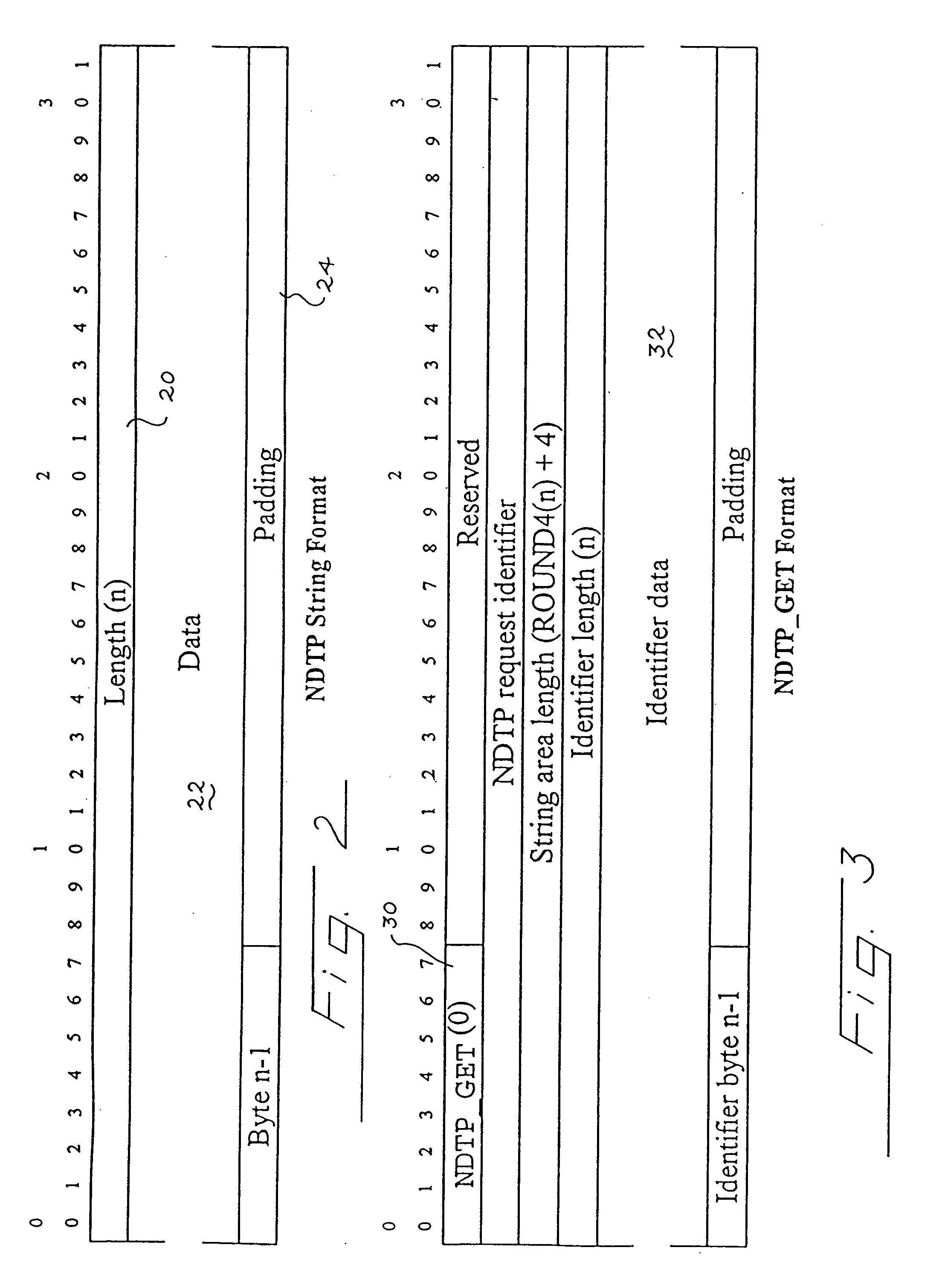

Network distributed tracking wire transfer protocol

InactiveUS20070011267A1Efficient changeEfficient managementDigital data information retrievalMultiple digital computer combinationsData acquisitionWire transfer

A network distributed tracking wire transfer protocol for storing and retrieving data across a distributed data collection. The protocol includes a location string for specifying the network location of data associated with an entity in the distributed data collection, and an identification string for specifying the identity of an entity in the distributed data collection. According to the protocol, the length of the location string and the length of the identification string are variable, and an association between an identification string and a location string can be spontaneously and dynamically changed. The network distributed tracking wire transfer protocol is application independent, organizationally independent, and geographically independent. A method for using the protocol in a distributed data collection environment and a system for implementing the protocol are also provided.

Owner:KOVE IO INC

Method and apparatus for implementing financial transactions

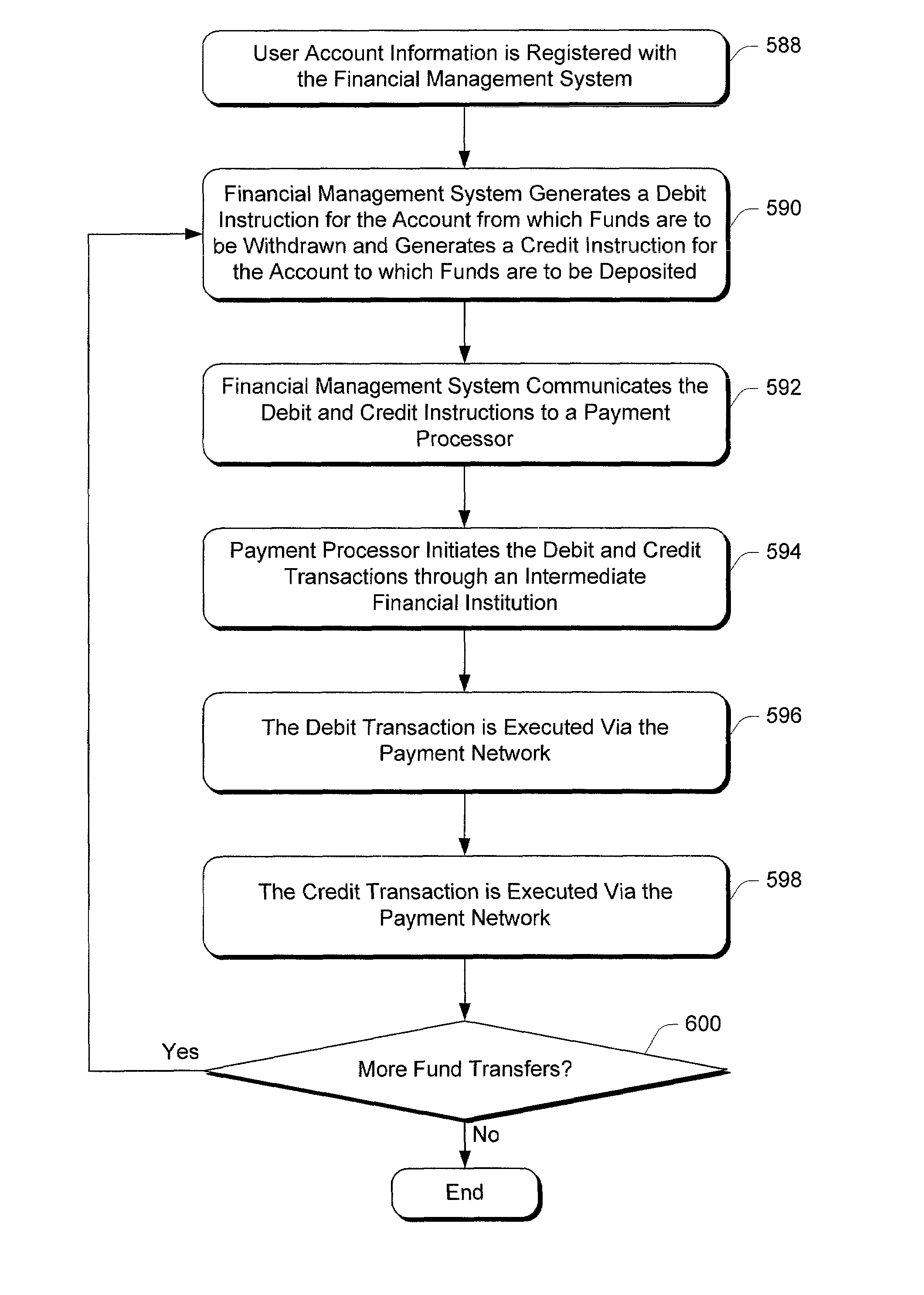

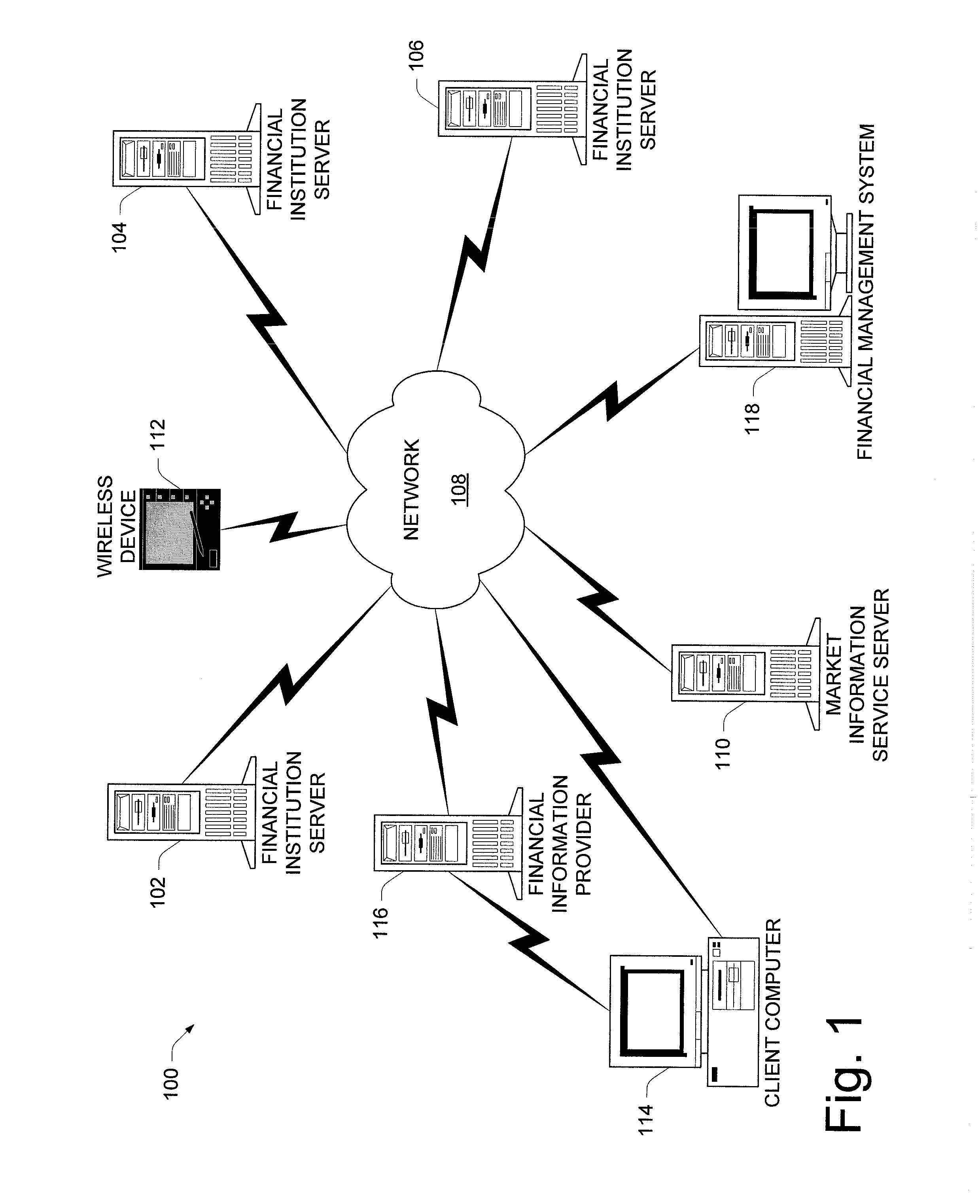

A withdrawal of assets is initiated from a first account at a first financial institution. A deposit of the assets withdrawn from the first account is initiated to a second account at a second financial institution. The first account and the second account have a common account holder. The withdrawal and deposit of assets may be initiated after analyzing multiple accounts of the account holder and determining whether an adjustment of funds among the multiple accounts would benefit the account holder. A debit instruction is used to initiate the withdrawal of assets and a credit instruction is used to initiate the deposit of the withdrawn assets. The withdrawal and deposit of assets can be implemented using one or more payment networks, debit networks, or a wire transfer between the two financial institutions.

Owner:CASHEDGE INC

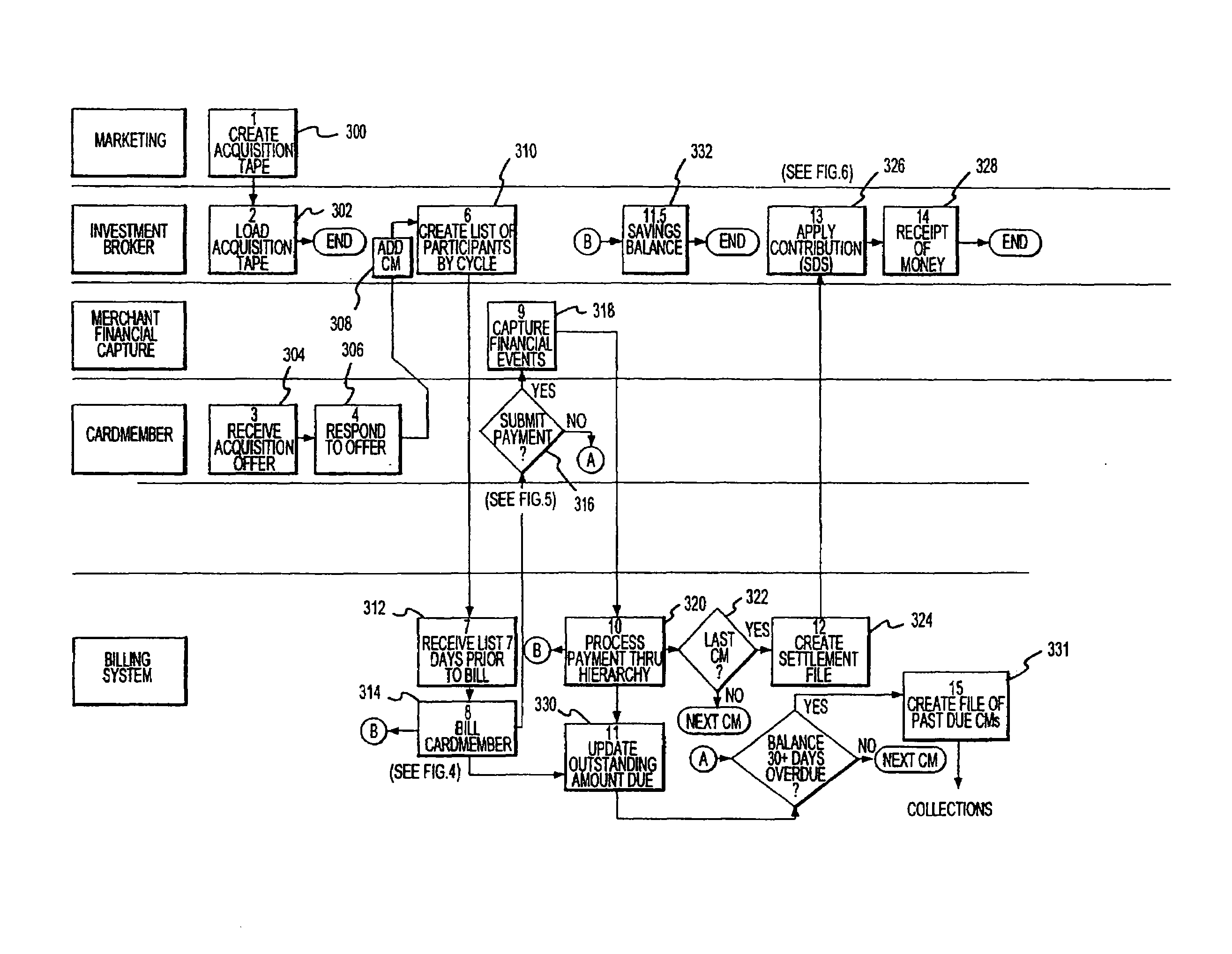

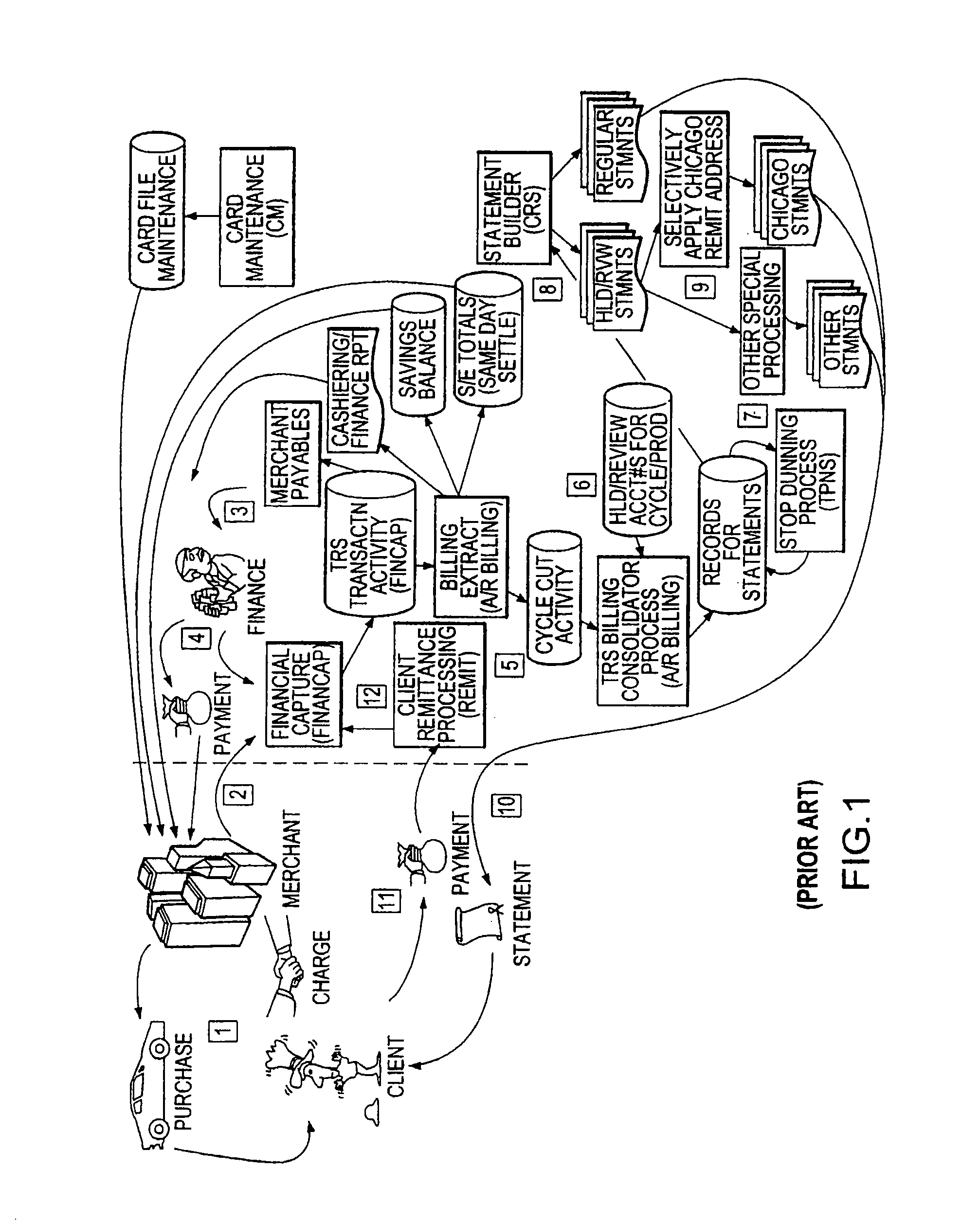

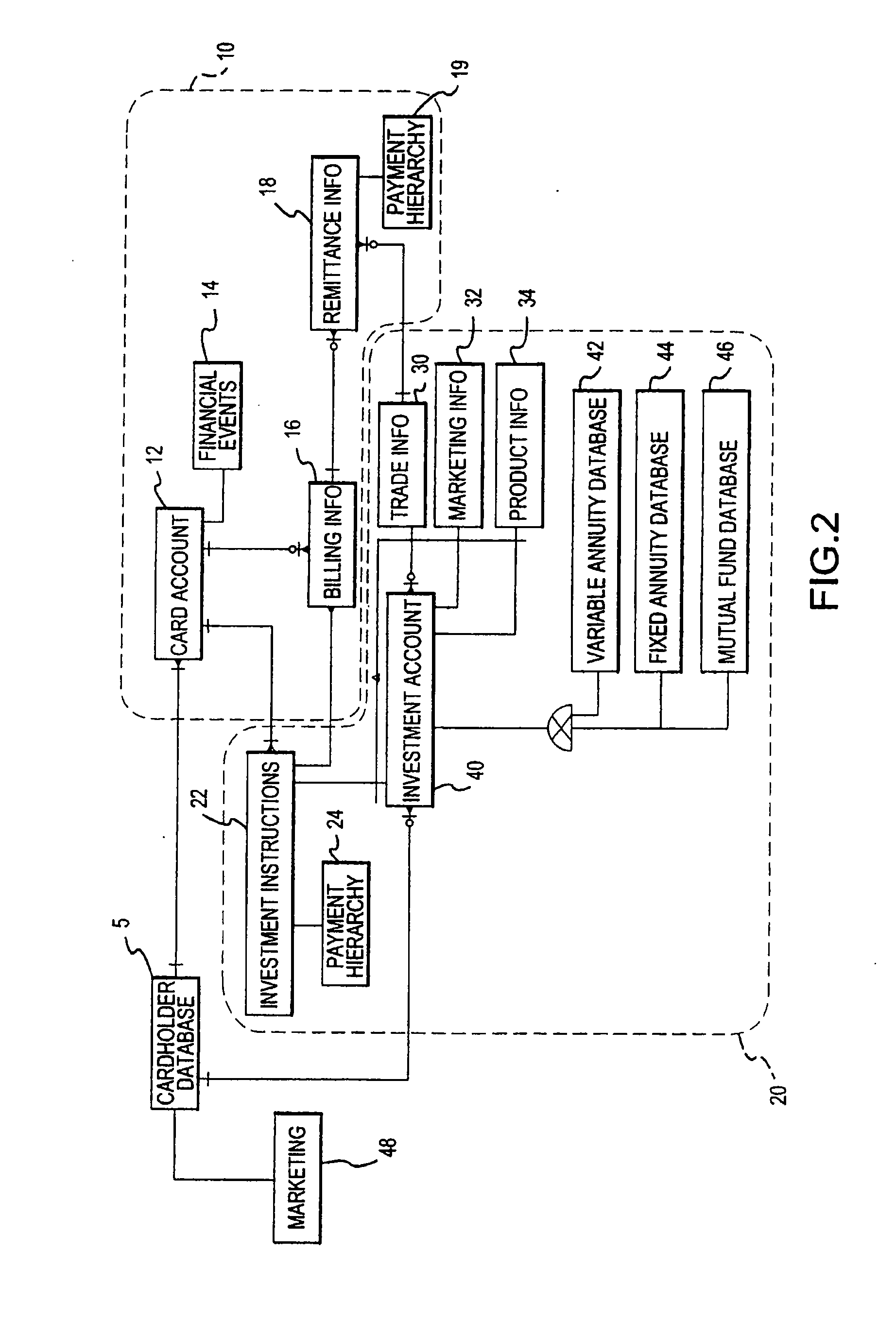

System and method for dividing a remittance and distributing a portion of the funds to multiple investment products

A known charge card billing system communicates with an investment broker system, wherein the investment broker system includes an instruction arrangement database, payment hierarchy and an investment account. An interested cardholder suitably appoints the charge card administrator as a processing agent to collect and promptly remit the cardholder's voluntary, periodic payments for investment into preselected investment products, such as, for example, mutual fund shares, fixed annuities, variable annuities, CDs, insurance, certificates, equities and / or the like. The billing system distributes a billing statement at the end of each month, wherein the statement includes all of the charges for that month and a reminder to remit an additional dollar amount for the preselected investments. The cardholder then sends a single payment for the charges and the investments to the charge card administrator. After receiving the payment, the system appropriately unbundles the payment and distributes the remitted payment to the card account to satisfy the captured financial events and to the investment broker system for the purchase of investment products.

Owner:AMERIPRISE FINANCIAL

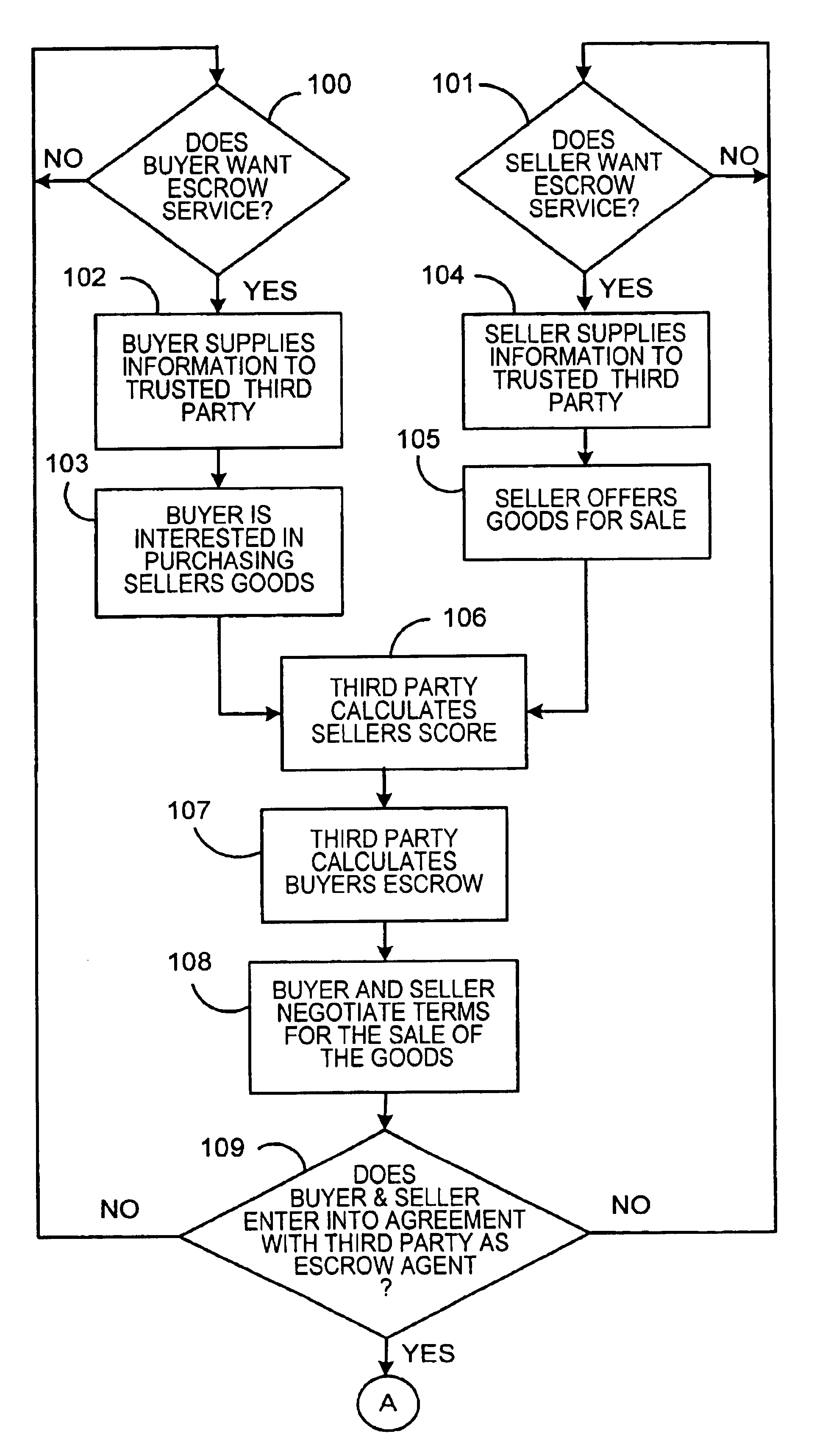

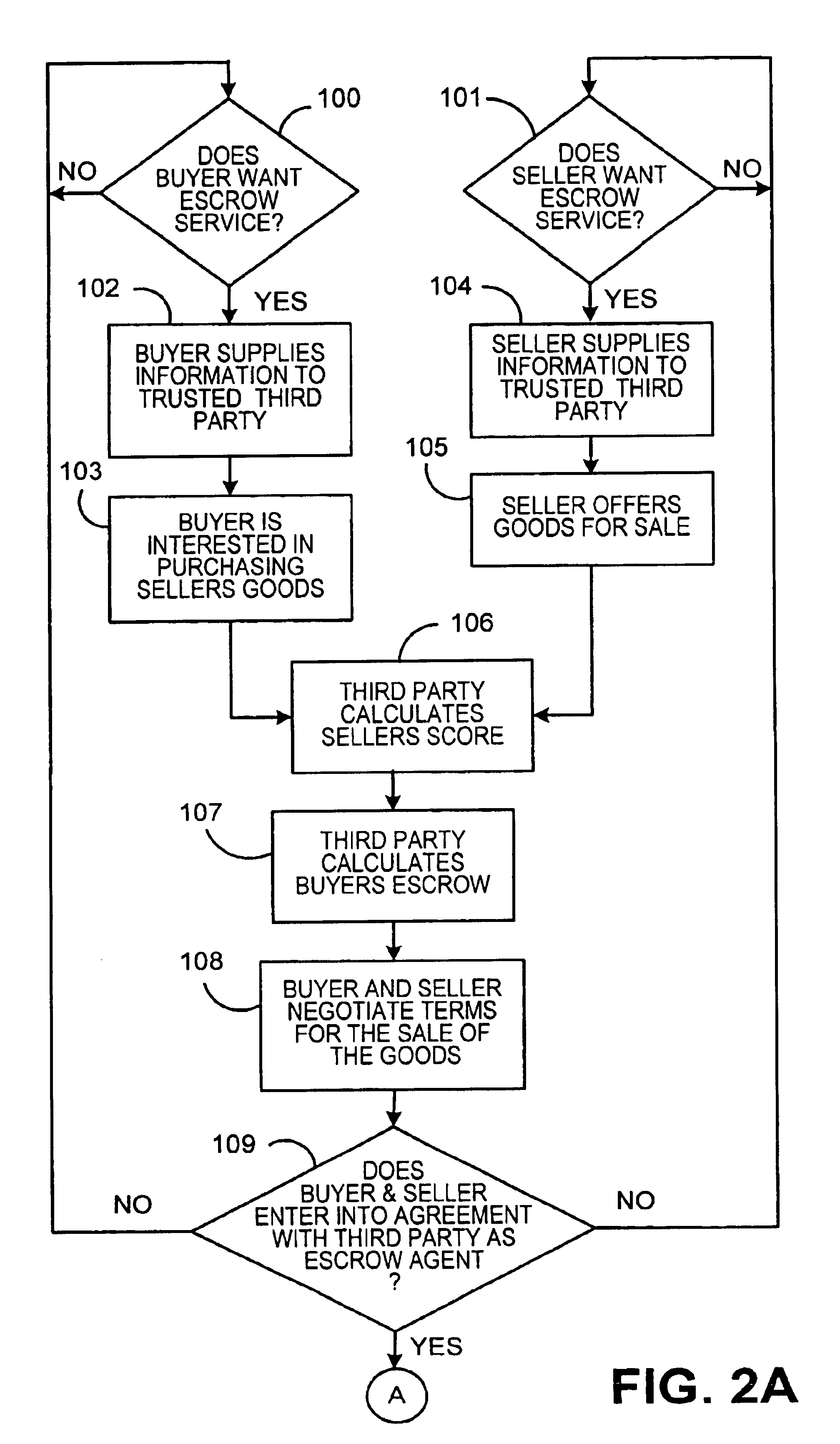

System for conducting business over the internet

An Internet-based system that allows a buyer and a seller to obtain information about each other while remaining somewhat anonymous. The system provides historic information to buyer and seller by having a trusted third party give the buyer and seller the other party's trading history information without revealing the actual identity of the parties. A buyer registers with the trusted third party by submitting an online application. The trusted third party establishes a credit score for the buyer. A seller registers with the trusted third party by submitting an online application. The trusted third party establishes a score for the seller based upon the seller's trading history, reputation and financial standing. When the buyer chooses to purchase a product from a seller over the Internet, certain parameters i.e., dollar value of transaction, type of purchase, level of current outstanding credit available, credit score, etc. are substituted into an algorithm to determine the maximum purchase amount that may be financed at what terms and how much money the buyer will have to place in escrow. The buyers escrow may be furnished to the trusted third party by credit cards, ACH, wire transfer, etc. If the trusted third party is not satisfied with the seller's score, the trusted third party may require the seller to post a bond for some or all of the seller's transactions.

Owner:PITNEY BOWES INC

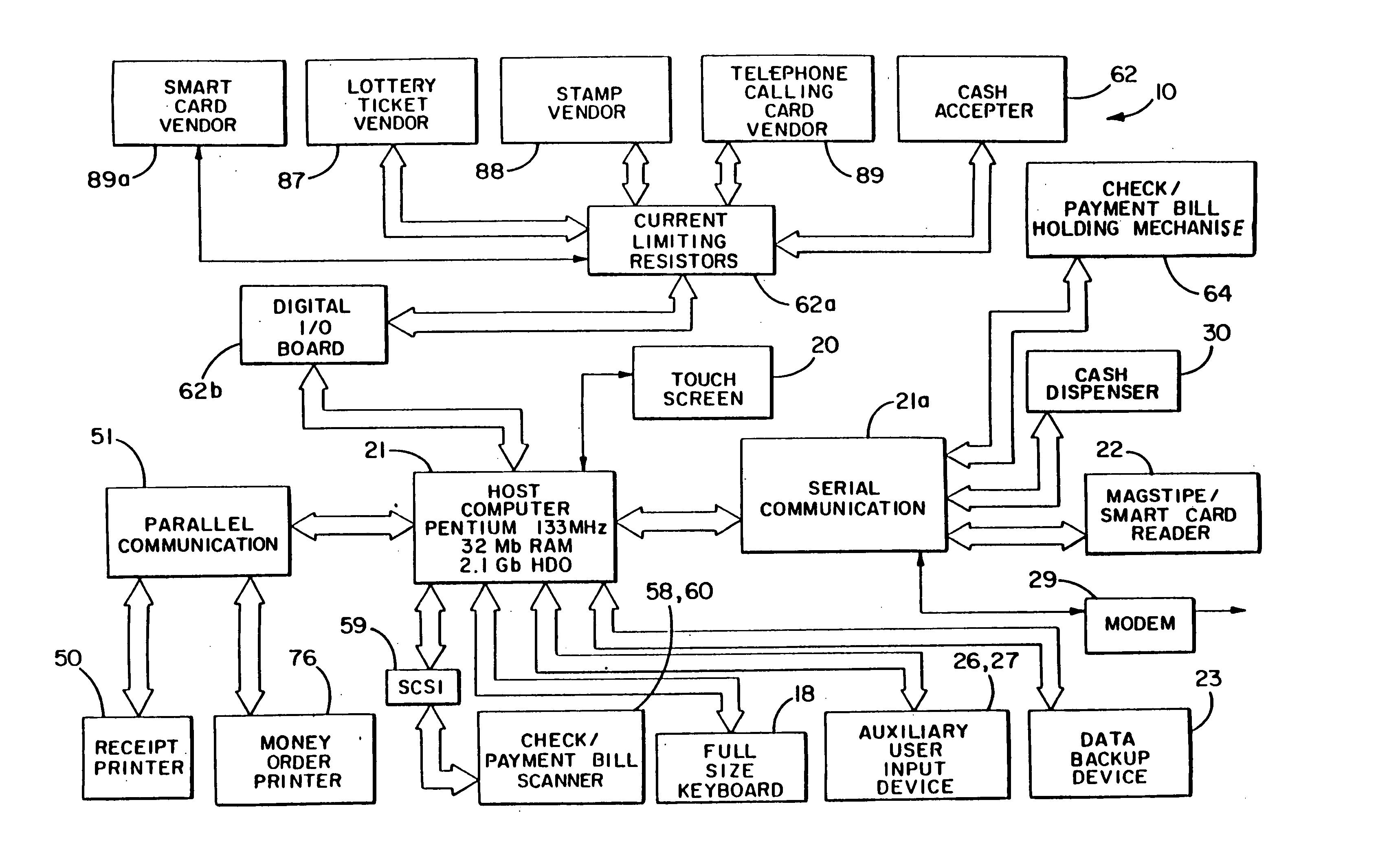

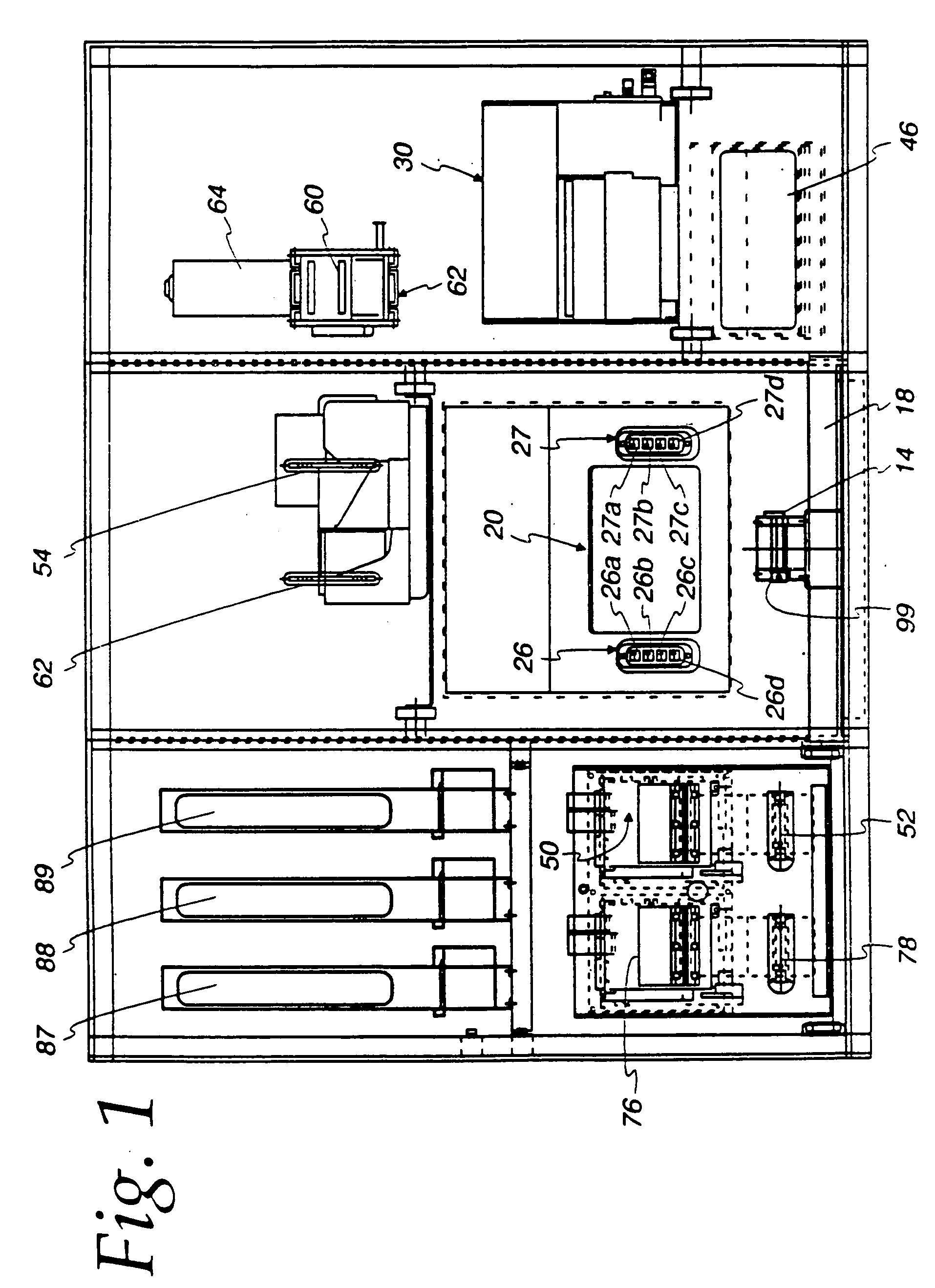

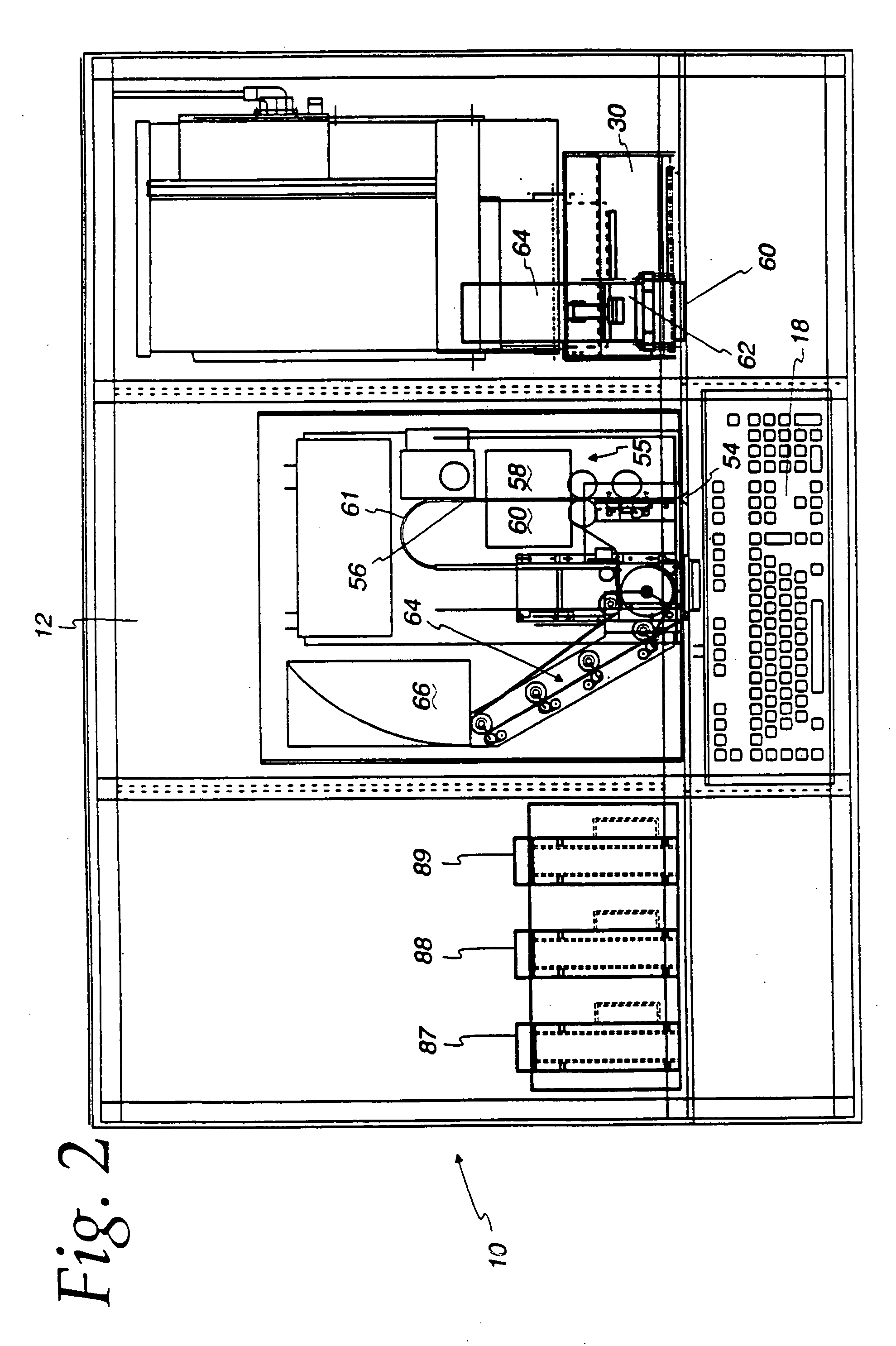

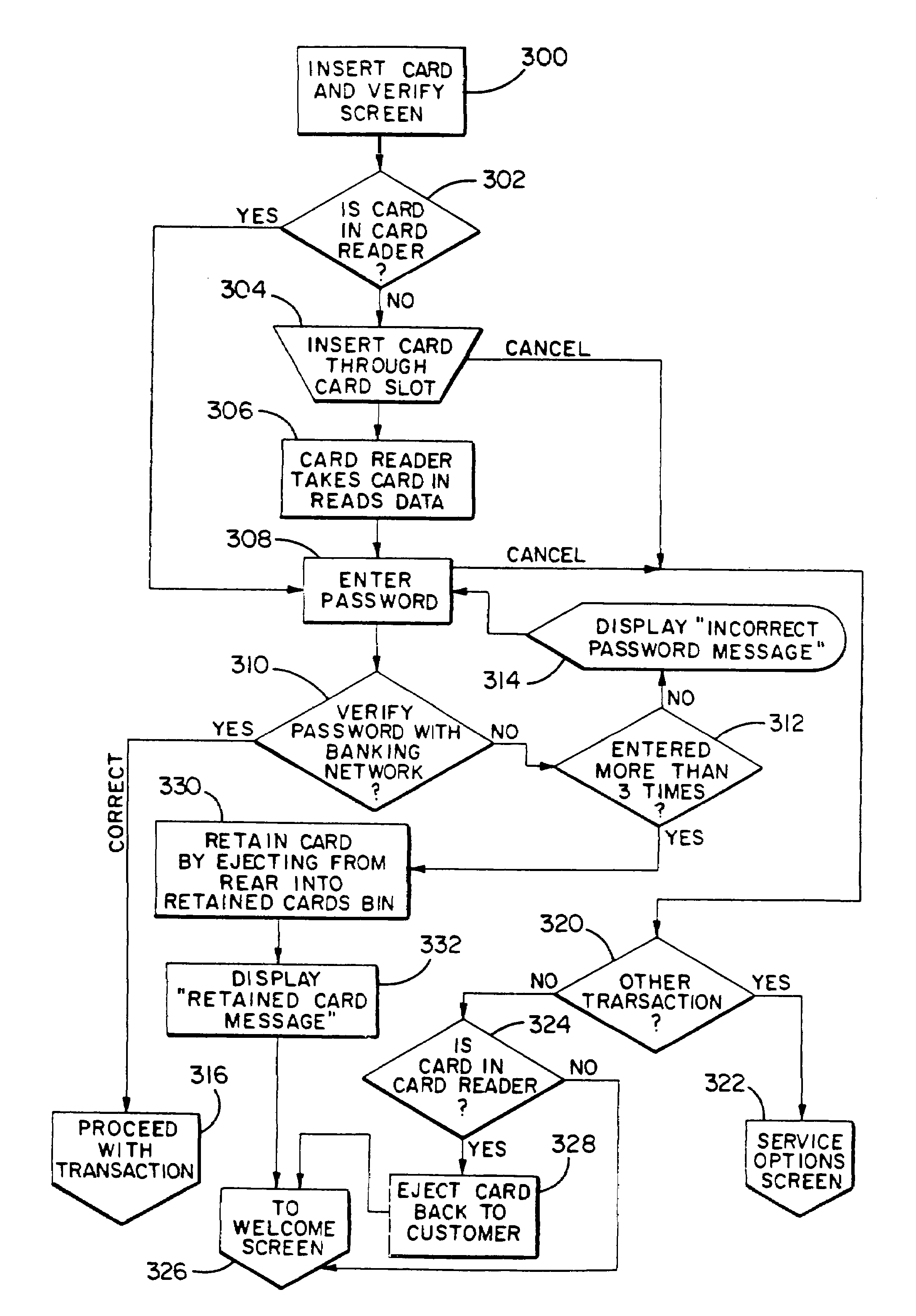

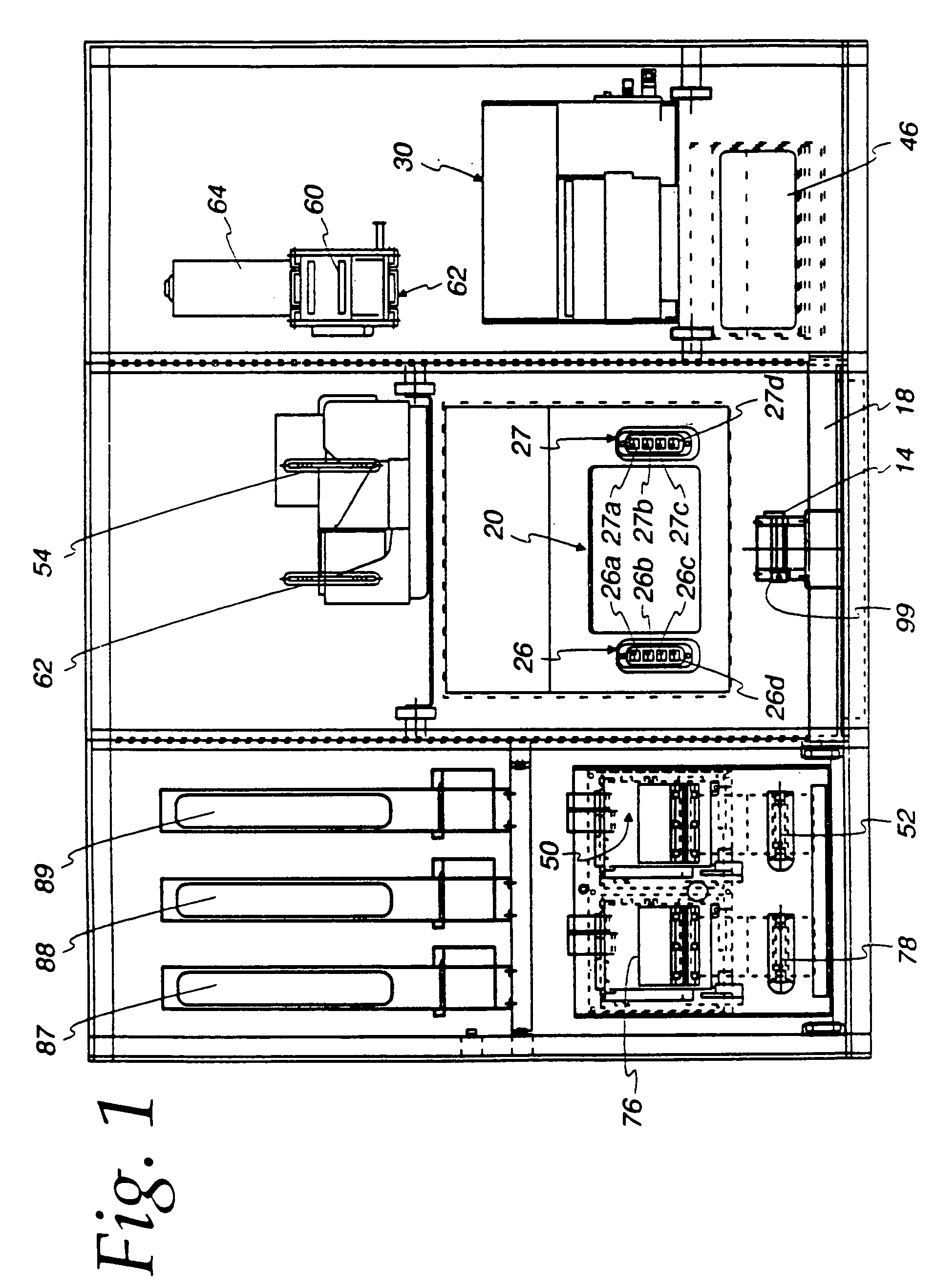

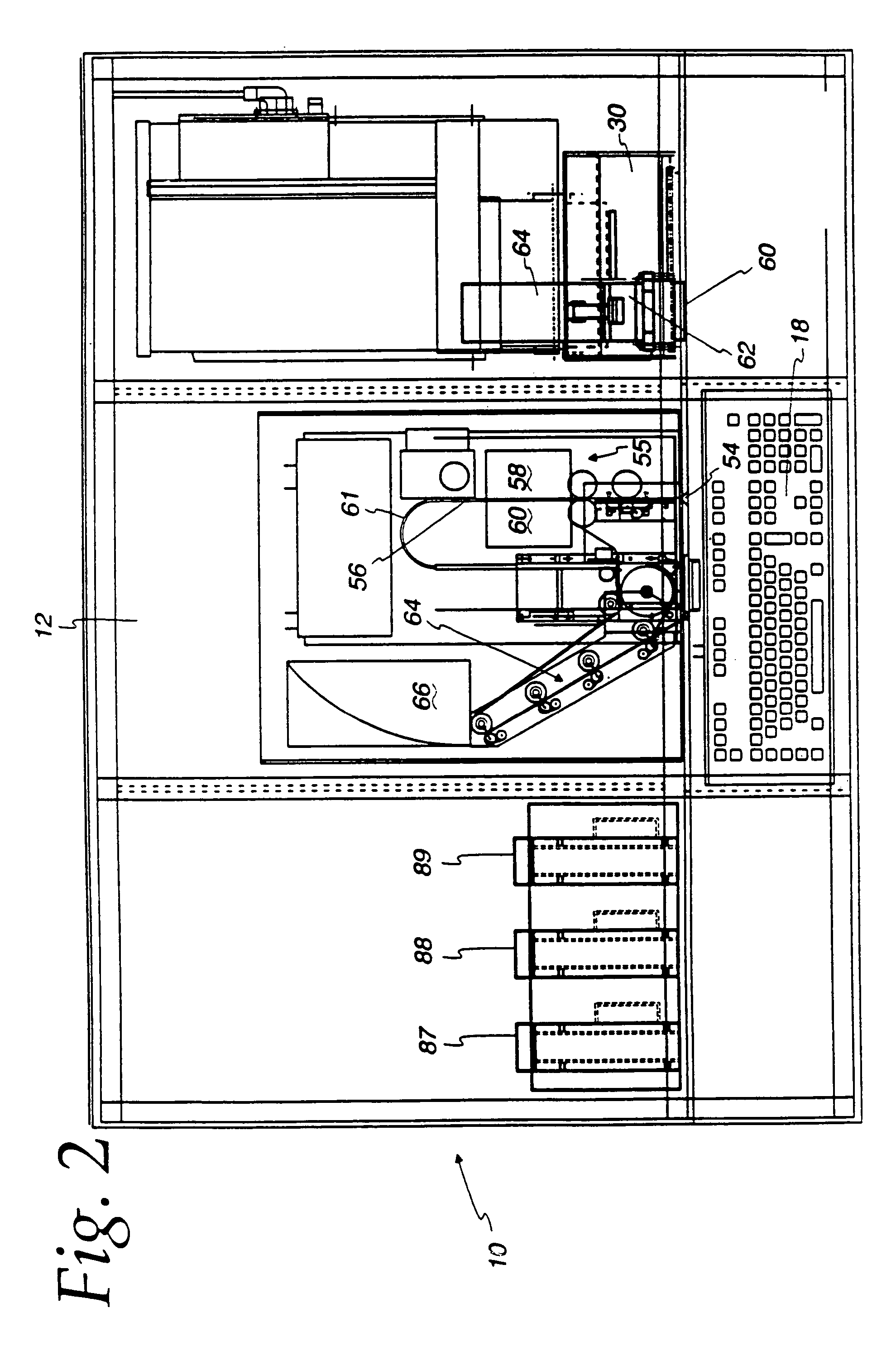

Automated document cashing system

An automated document cashing system is provided with an automated machine that cashes monetary transaction documents such as checks, money orders, and that makes deposit entries into the bank account of the user after validation of the user and monetary transaction document, without the aid of a bank teller. Validation of the identity of the user is performed with the use of a card associated with intelligence that identifies the user. A biometric device also may be used in identifying the validity of the user. Validation of the document involves one or more of: validating the presence of a signature; validating the amount of the monetary transaction document including a manual entry of the amount by the user; validating CAR against the LAR; and validating the banking system parameters and rules for the customer and / or the transaction. To assist in the automatic analysis of data on monetary transactional documents or on remittance documents, the user is prompted to provide a bounding box about the data. An image touch screen may be touched by the user to locate the bounding box and the user may magnify the data to fill the boundary box to exclude other data from this analysis. After document and person validation, the system will dispense money or transfer monies to a savings account, a checking account, a smart card, or the like. The system will also write money orders or wire transfer money. By supplying monies in the form of cash, credit card authorization, smart card balance, or the like to the machine, the user can pay bills such as a utility bill through the system or purchase items dispensed by the system.

Owner:UTILX CORP +2

Automated document cashing system

InactiveUS7653600B2Magnification factor would decreaseAvoid zoom overshootComplete banking machinesFinanceCredit cardBank teller

An automated document cashing system is provided with an automated machine that cashes monetary transaction documents such as checks, money orders, and that makes deposit entries into the bank account of the user after validation of the user and monetary transaction document, without the aid of a bank teller. Validation of the identity of the user is performed with the use of a card associated with intelligence that identifies the user. A biometric device also may be used in identifying the validity of the user. Validation of the document involves one or more of: validating the presence of a signature; validating the amount of the monetary transaction document including a manual entry of the amount by the user; validating CAR against the LAR; and validating the banking system parameters and rules for the customer and / or the transaction. To assist in the automatic analysis of data on monetary transactional documents or on remittance documents, the user is prompted to provide a bounding box about the data. An image touch screen may be touched by the user to locate the bounding box and the user may magnify the data to fill the boundary box to exclude other data from this analysis. After document and person validation, the system will dispense money or transfer monies to a savings account, a checking account, a smart card, or the like. The system will also write money orders or wire transfer money. By supplying monies in the form of cash, credit card authorization, smart card balance, or the like to the machine, the user can pay bills such as a utility bill through the system or purchase items dispensed by the system.

Owner:UTILX CORP +2

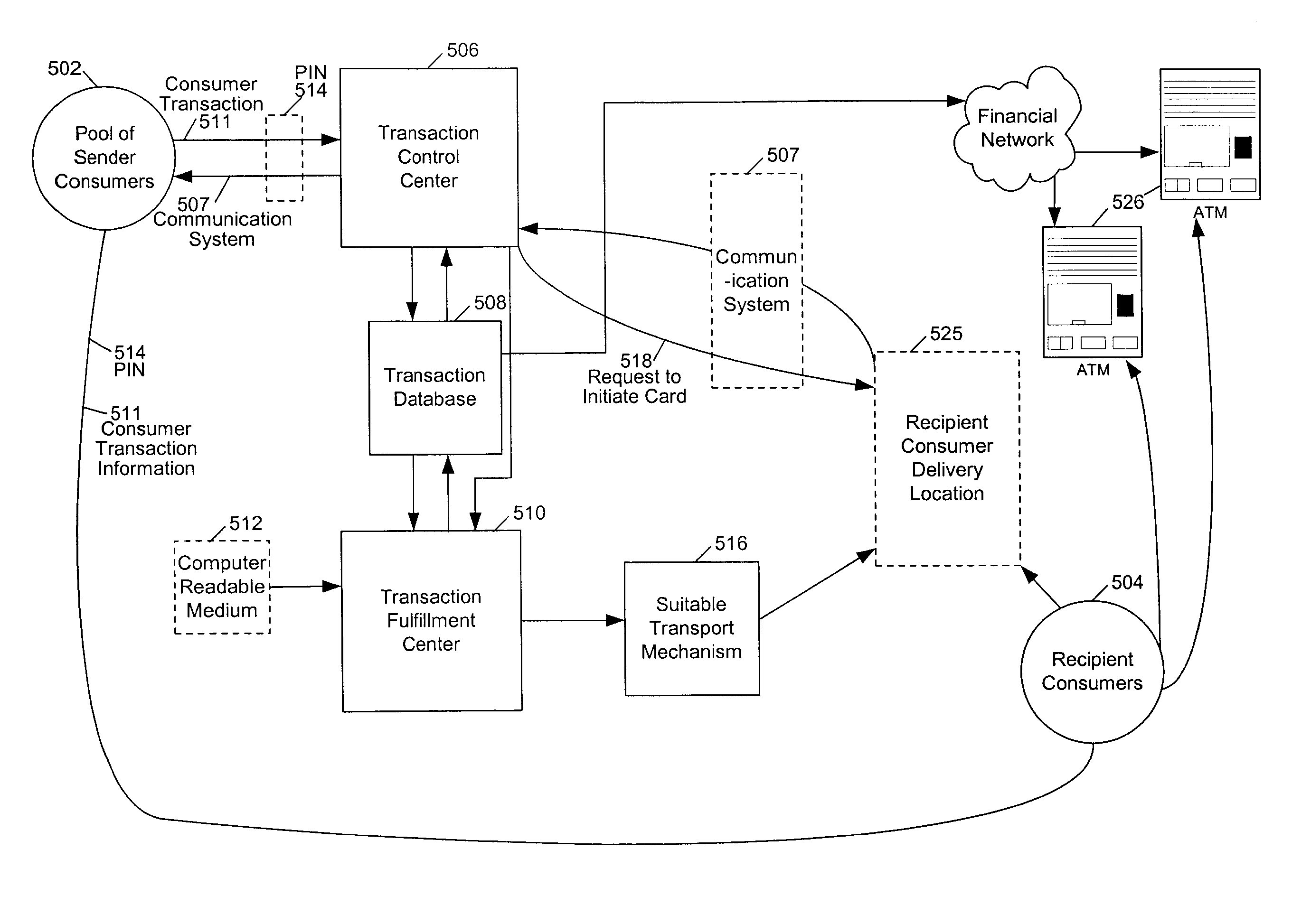

Improved money transfer system and method with added security features

InactiveUS20030028491A1Credit registering devices actuationATM softwaresThird partyComputerized system

<heading lvl="0">Abstract of Disclosure< / heading> Disclosed are improved computer systems and methods for money transfers completed by one-time use computer readable media for use in cash dispensing networks of computers (ATMs) as an alternative to a traditional wire transfer. In another embodiment a consumer may purchase these computer media at a third party location, which then allows the consumer to use it as portable electronic draft which substitutes for a traditional traveler 's check.

Owner:COOPER JONATHAN D

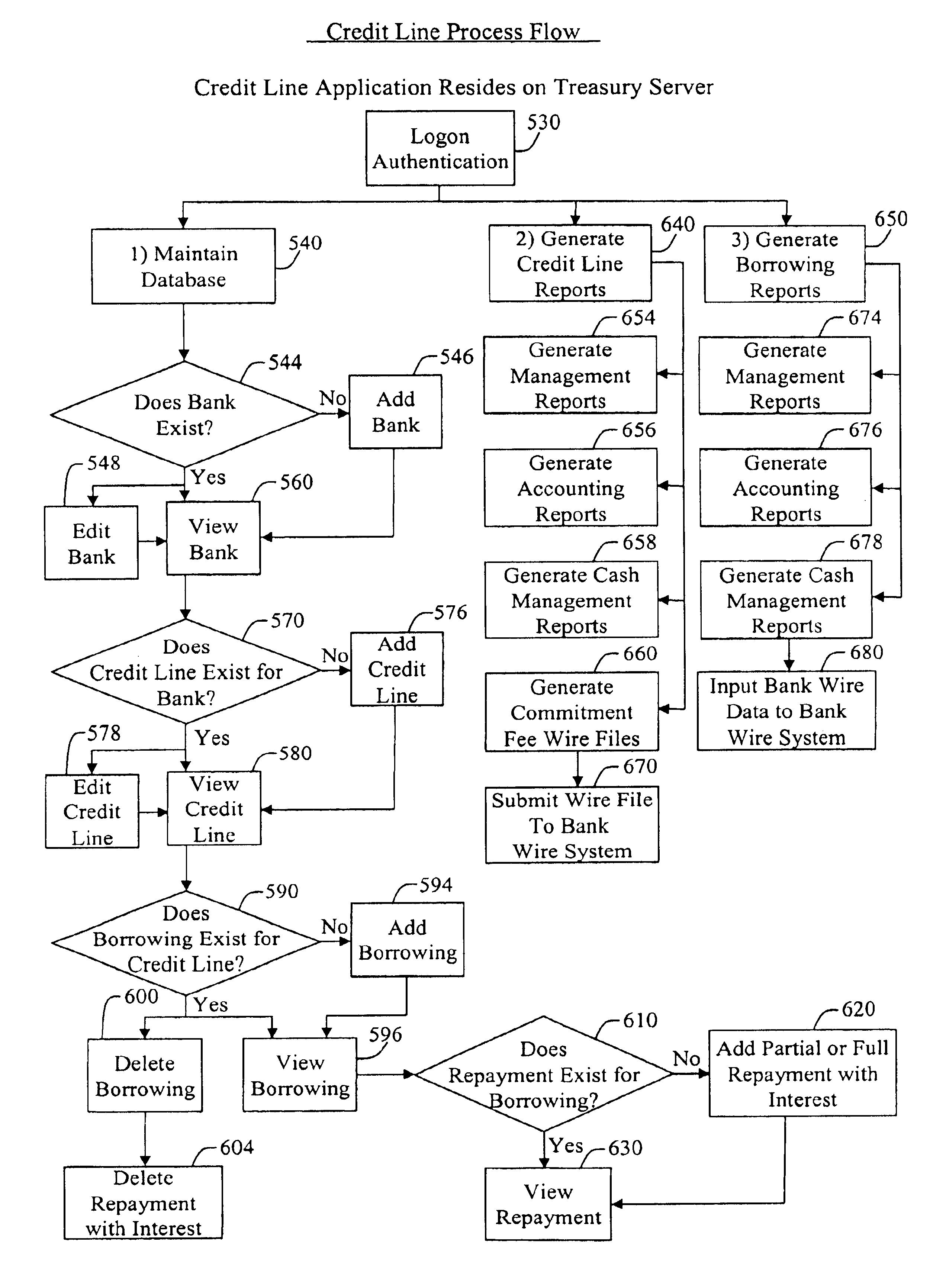

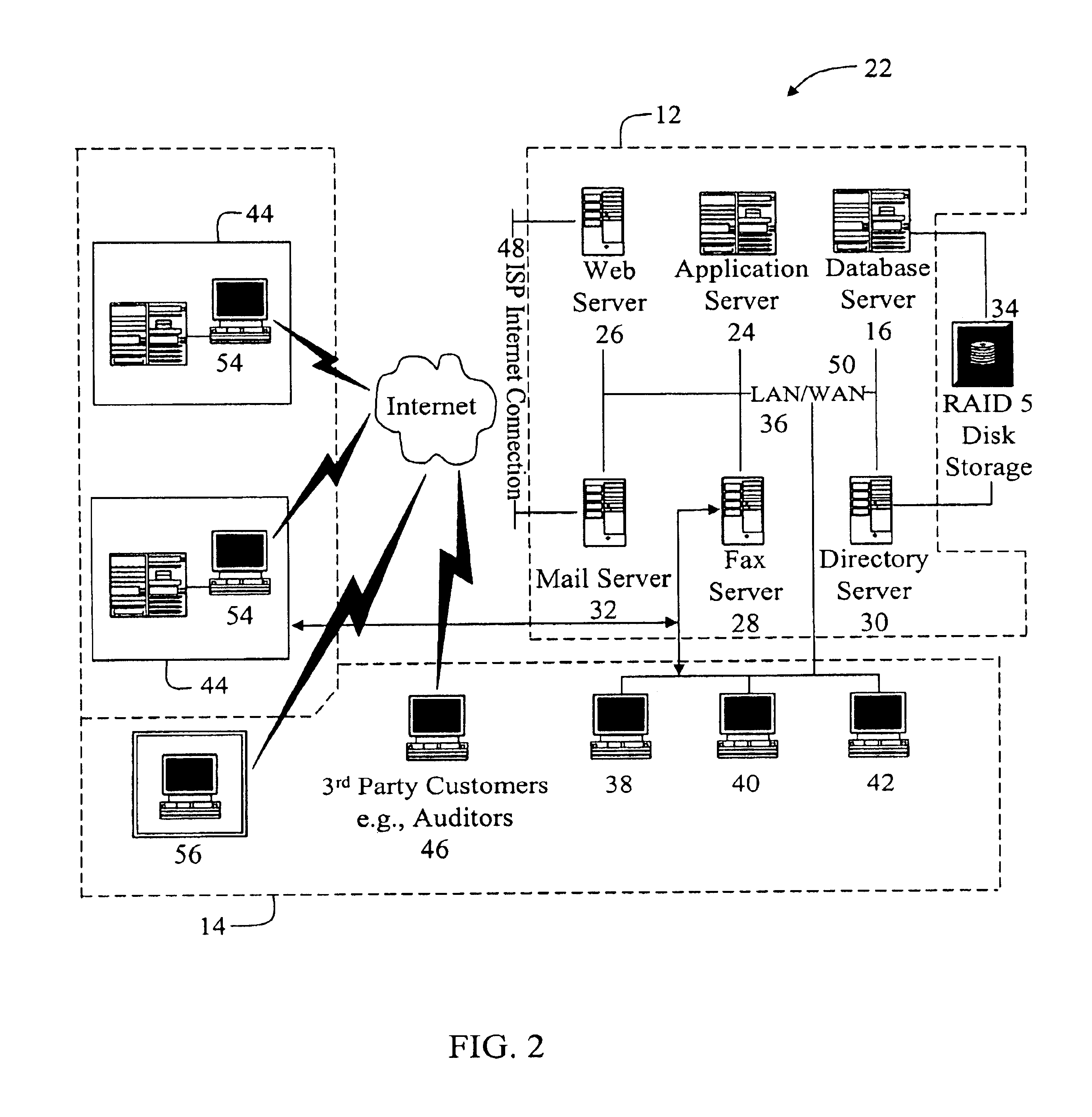

Systems and methods for credit line monitoring

InactiveUS6873972B1Facilitates efficient credit line monitoringFinanceCredit schemesCentralized databaseCentral database

In one embodiment, the present invention is a method and a system for tracking bank credit lines and borrowing. The method involves tracking credit ratings of a bank, requesting the bank to establish a line of credit, accessing a centralized database to obtain and maintain information regarding the line of credit, automatically transmitting domestic and international wire information for cash movement to the bank, and finally posting borrowing journal entries to a general ledger for financial monitoring, reporting and auditing purposes. The method and the system are capable of handling multi-currency transactions involving domestic and international banks.

Owner:GENERAL ELECTRIC CO

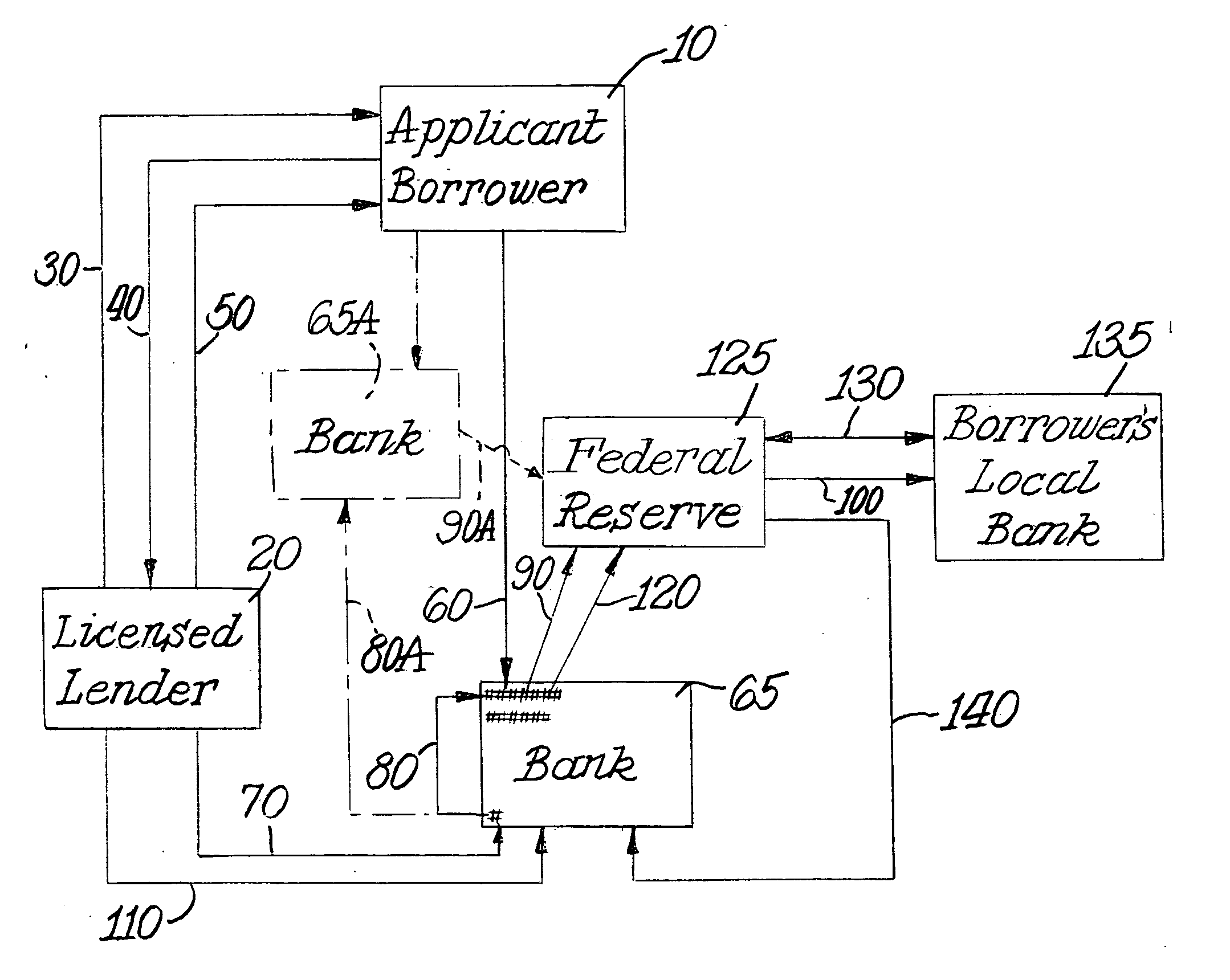

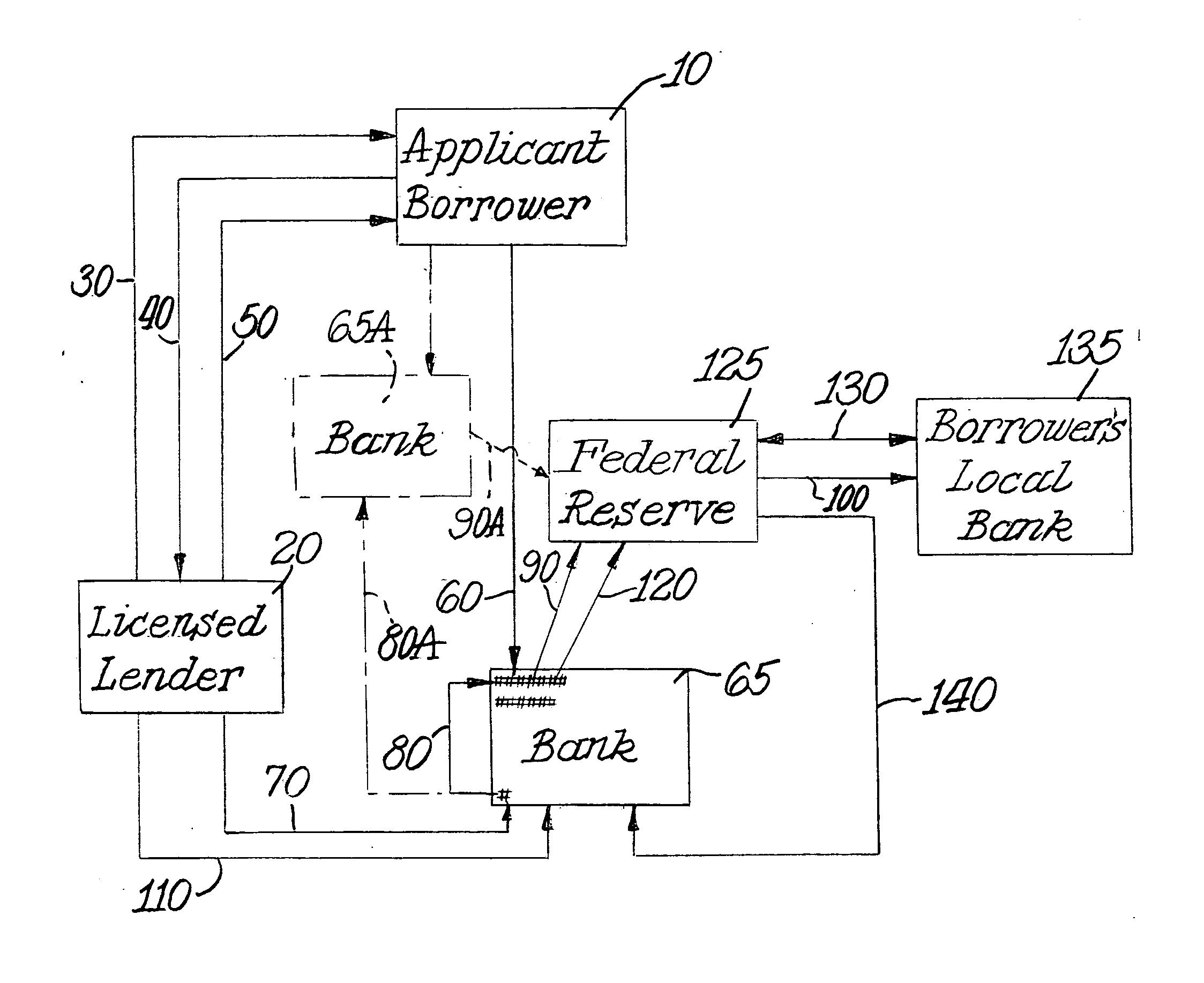

Method for licensed lender disbursement of loan proceeds to an out-of-state borrower to establish with greater certainty that the law of the state in which the licensed lender is located is the state law which governs the loan transaction

InactiveUS20050177489A1Simple methodFinanceSpecial data processing applicationsDocumentation procedureBank account

A method for disbursing loan proceeds, which has the following steps: (a) a borrower residing in a different jurisdiction from the location of a licensed lender contacting said lender about obtaining a loan; (b) said licensed lender forwarding the application to said borrower; (c) said borrower transmitting the executed loan application and requested documentation to said licensed lender; (d) said licensed lender accepting and processing the loan application; (e) said licensed lender approving the loan application; (f) said licensed lender pursuant to authorization of borrower automatically opening an account for said borrower at a banking institution located in the same state jurisdiction as such licensed lender and its banking institution; (g) said licensed lender disbursing the loan proceeds from its funding account at its banking institution to said borrower's newly created bank account; (h) such loan proceeds then being automatically wired from said borrower's new bank account at said banking institution in the same state jurisdiction as such the licensed lender and its banking institution to a bank checking account of said borrower in a different state jurisdiction where said borrower currently banks; (i) and, said licensed payday lender, pursuant to a pre-authorization by borrower, arranging repayment of such loan through the Federal Reserve to debit the loan amount and accrued interest and fees from said bank account of borrower in his / her home state jurisdiction by having such money wired to the bank account of the licensed lender at such licensed lender's banking institution.

Owner:NAT TITLE LOANS

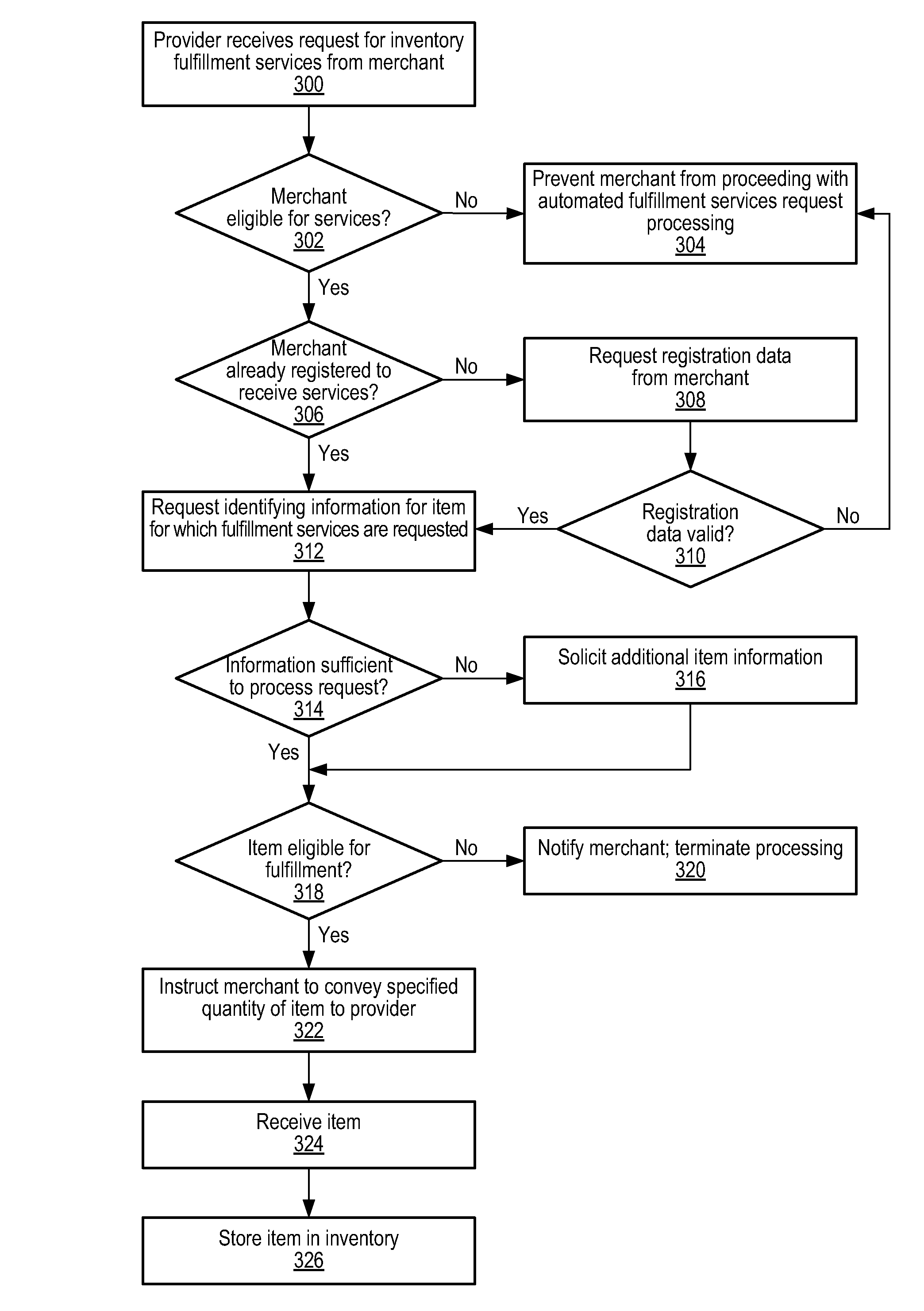

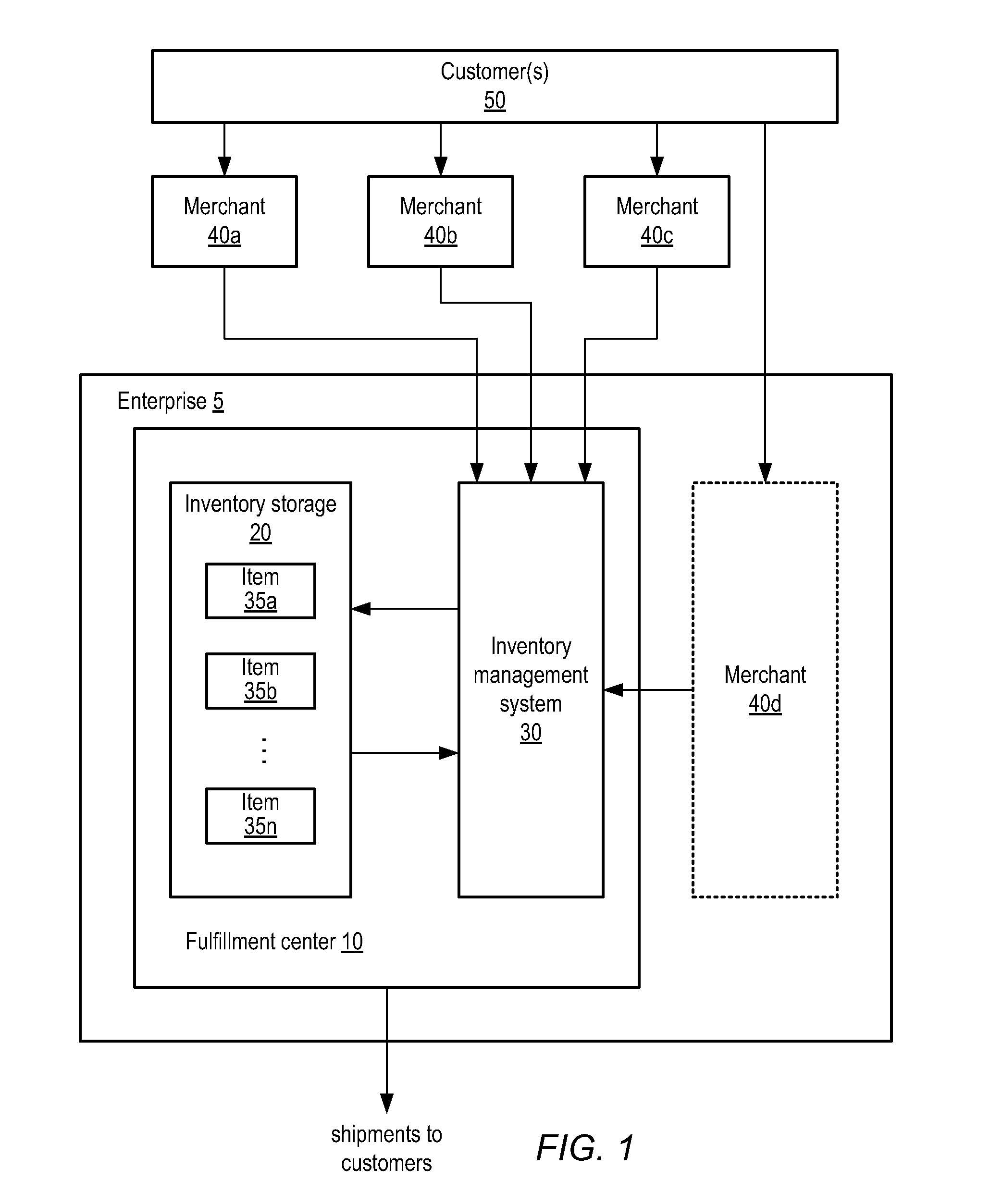

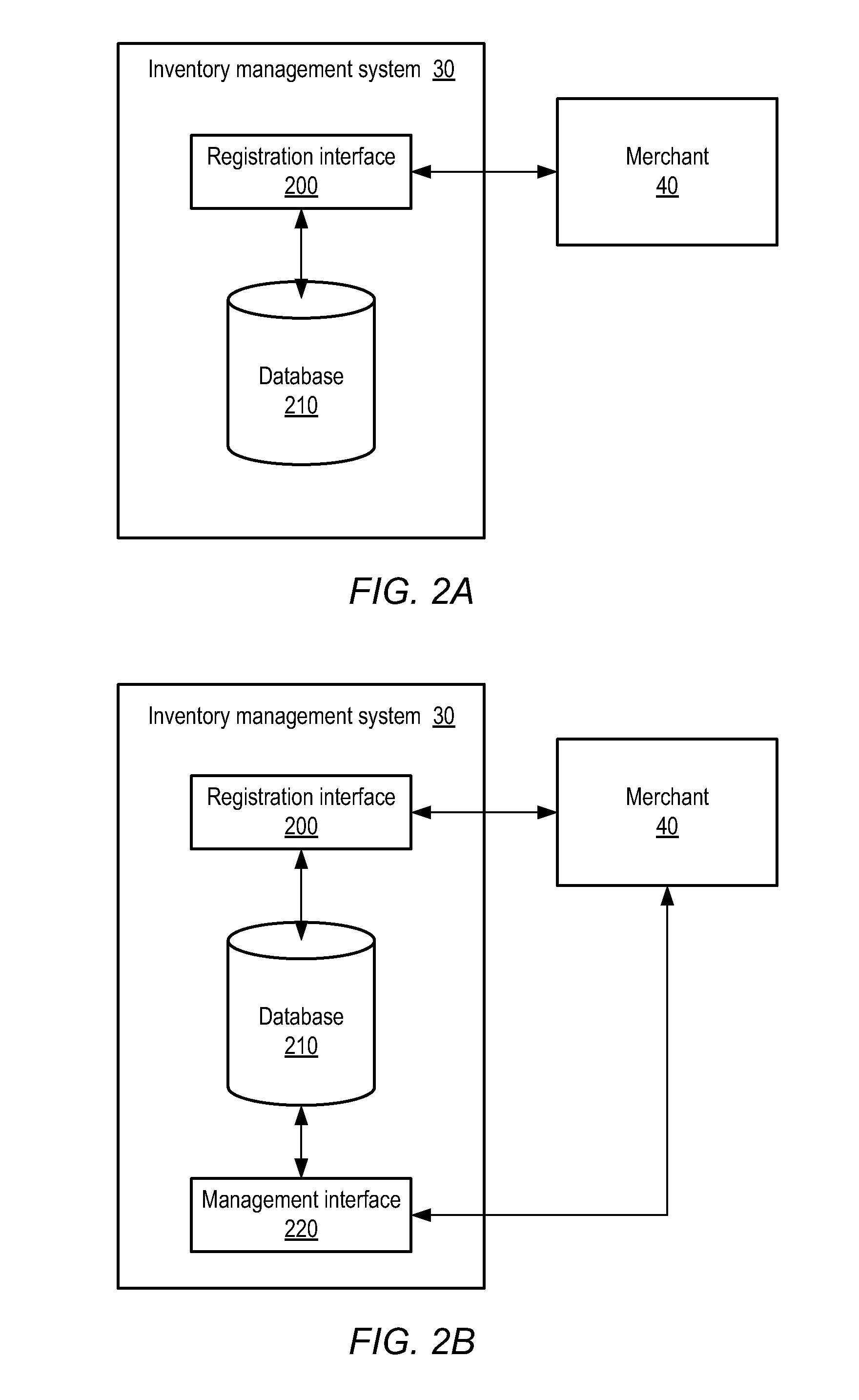

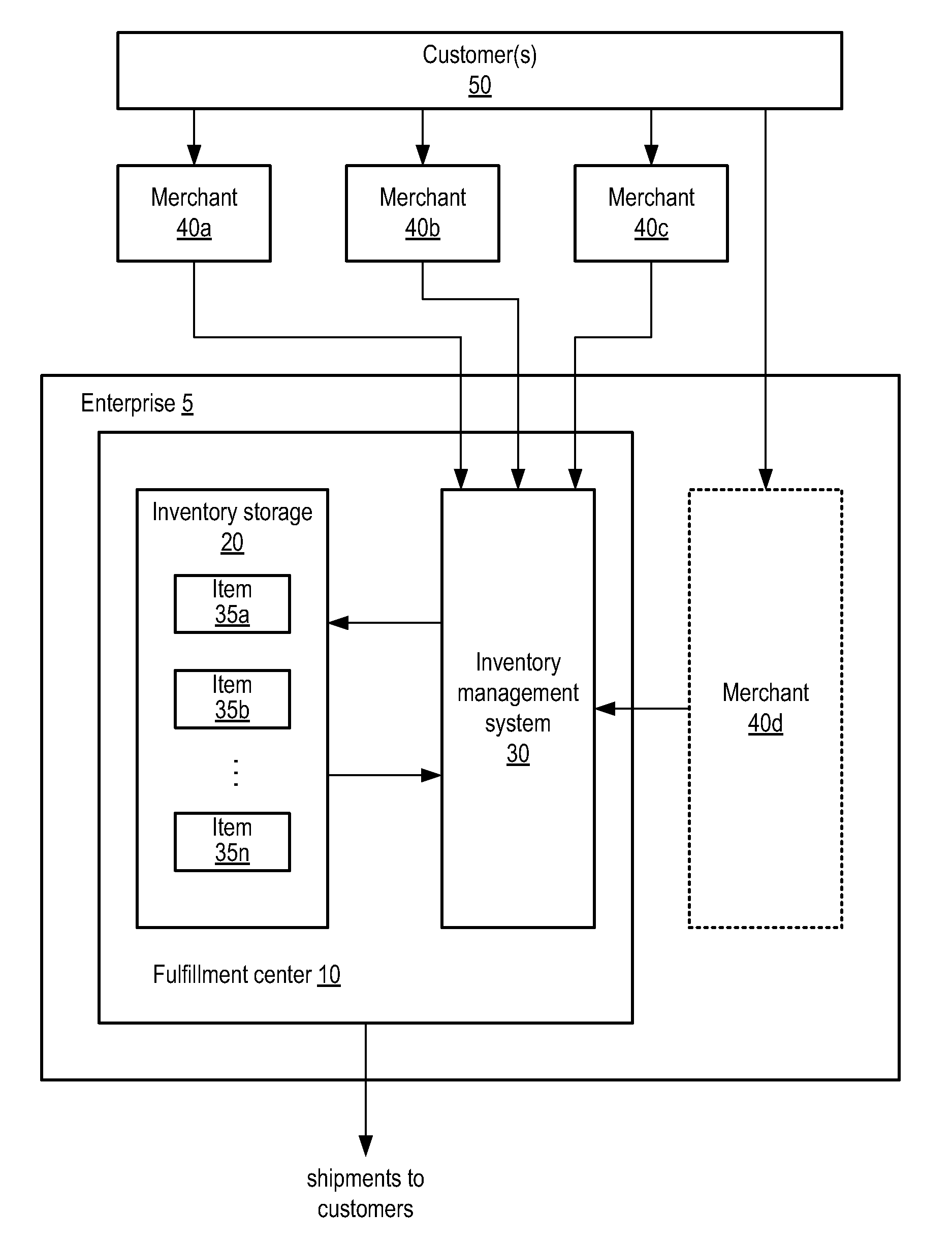

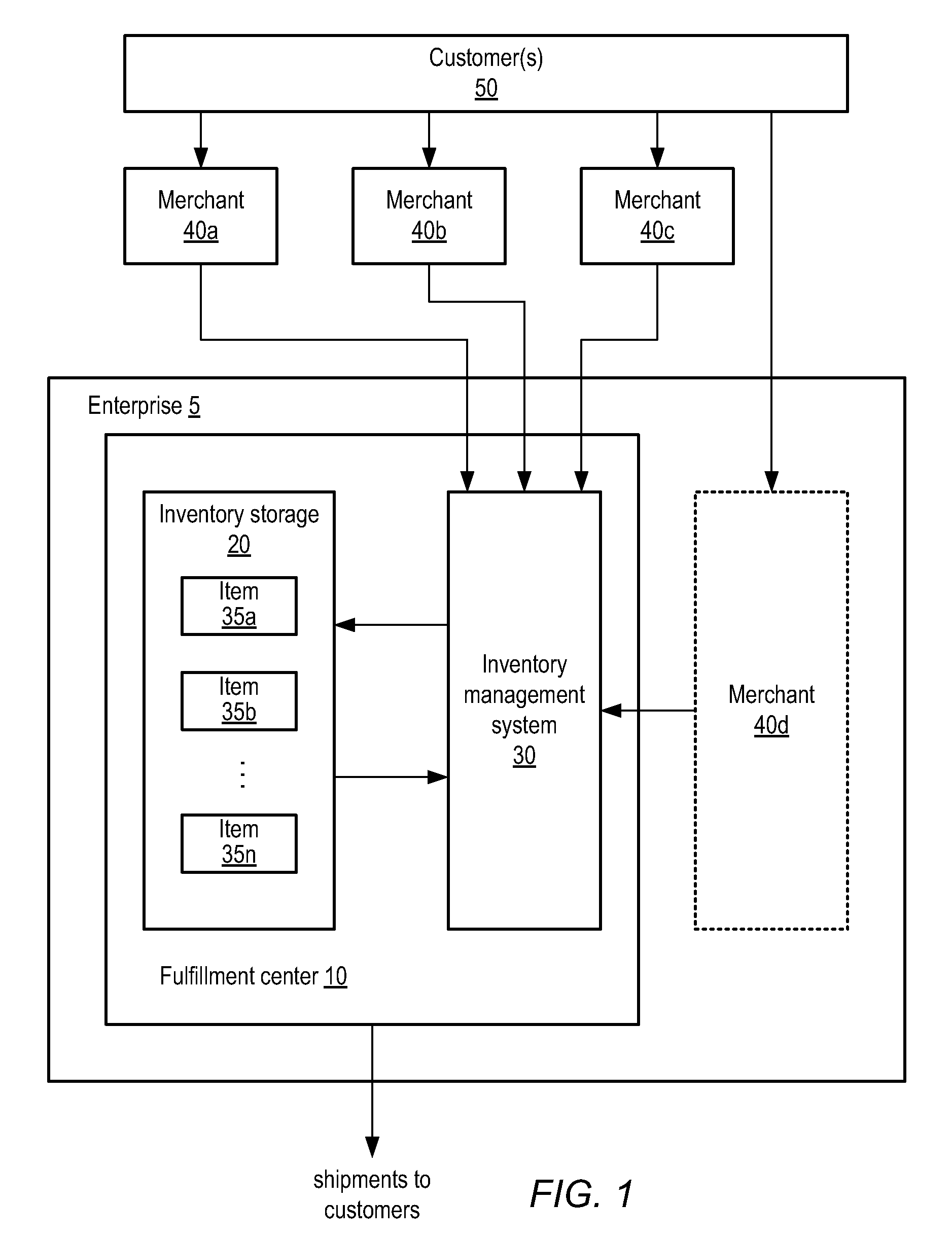

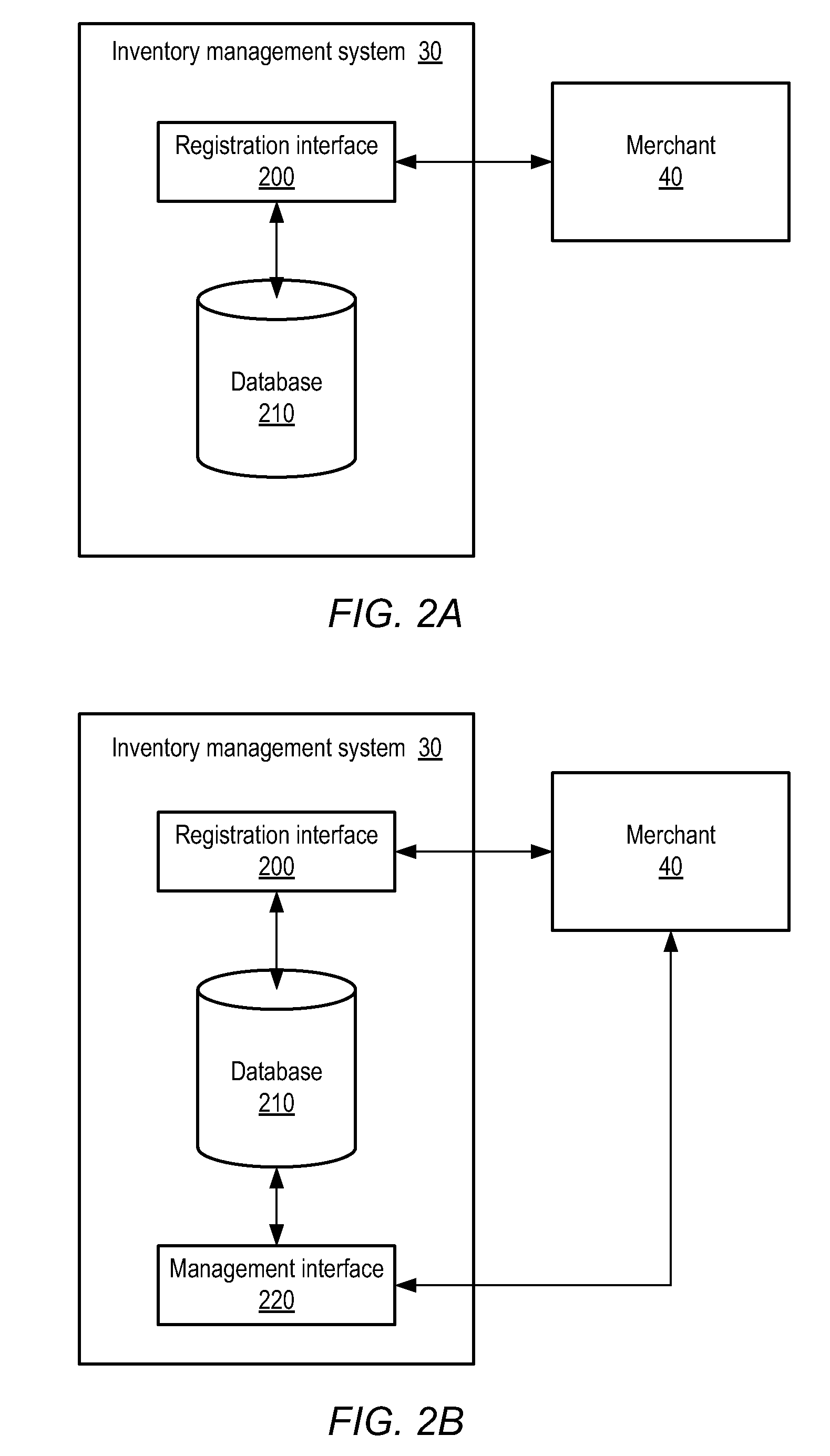

System and method for providing export services to merchants

InactiveUS20080294536A1Hand manipulated computer devicesPayment architectureOrder fulfillmentDocumentation procedure

A fulfillment services provider may offer export services to merchants, including generation of required export documentation; calculation, collection, and remittance of customs duties; and transportation via an international carrier. Such export services may be offered through a registration service, and may be integrated with other fulfillment services provided to registered merchants (e.g., domestic order fulfillment and / or warehousing of inventory), or may be offered to merchants that do not receive other fulfillment services from the provider. Export services may be provided to merchants who certify that all registered or specified items may be legally exported to all (or specified) international destinations, or the provider may verify compliance to export regulations on behalf of registered merchants. The provider may assume the role of Principal Party in Interest for registered merchants or the merchants may retain this role. Registration and provision of export services may be implemented in one or more software modules.

Owner:AMAZON TECH INC

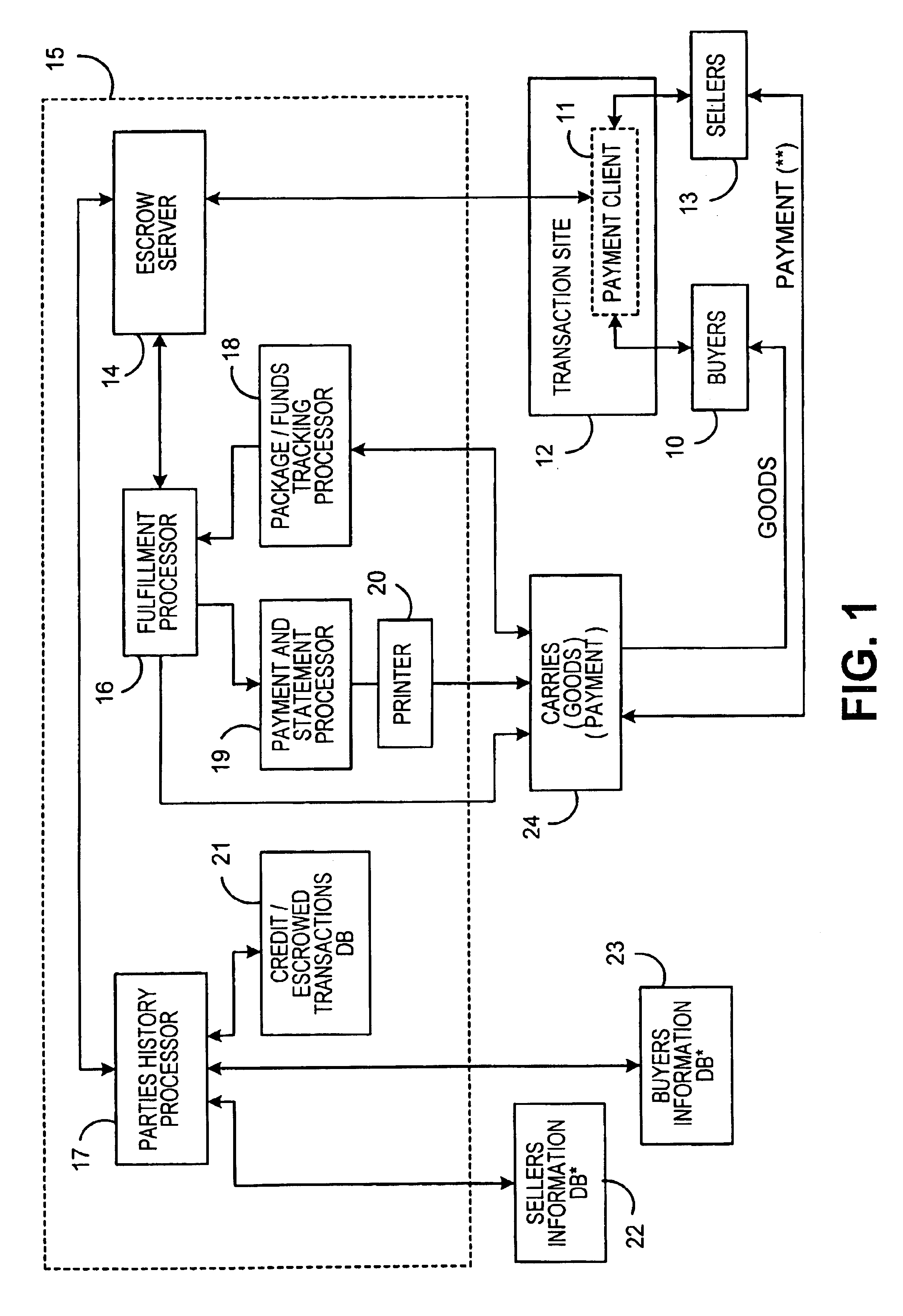

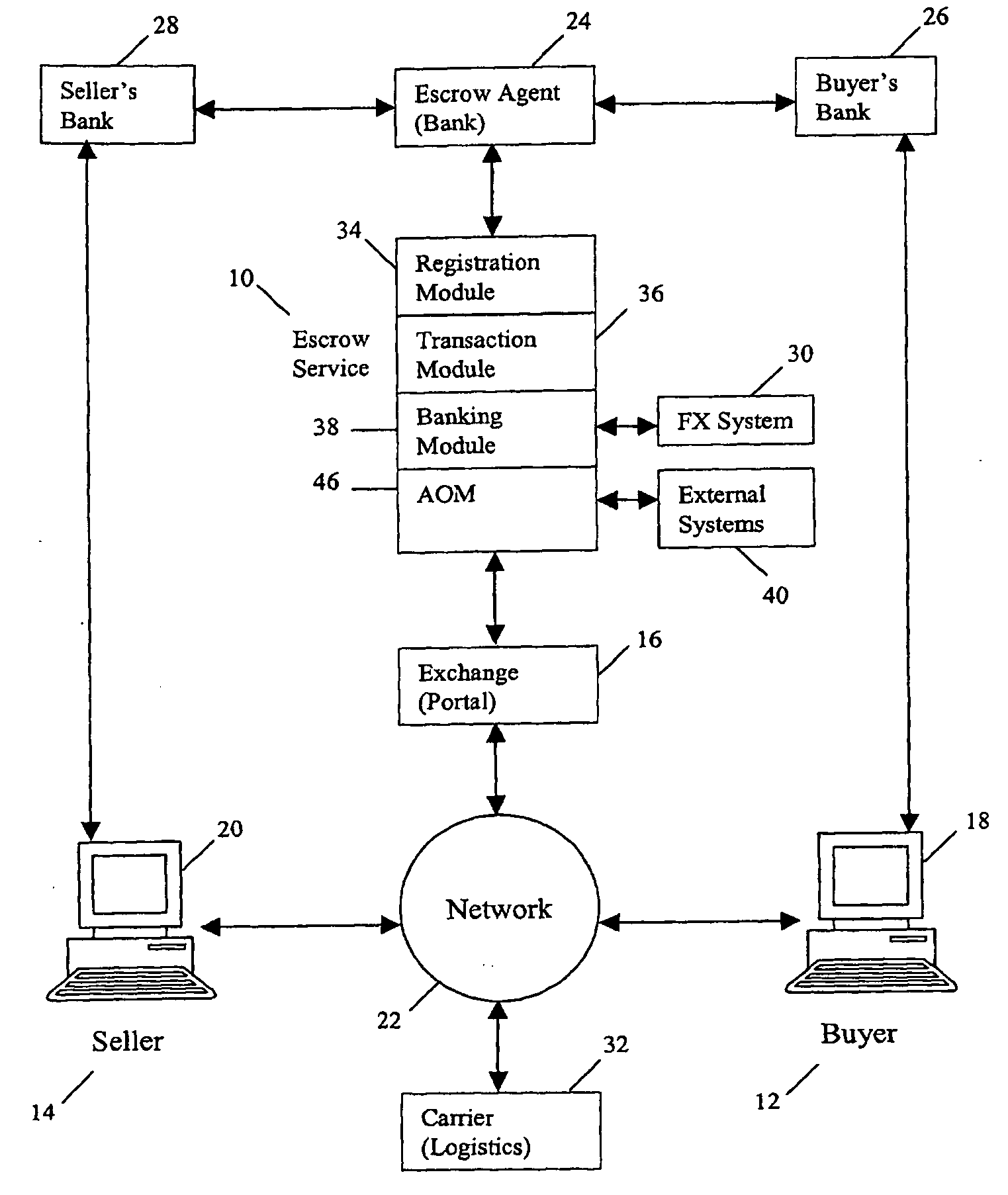

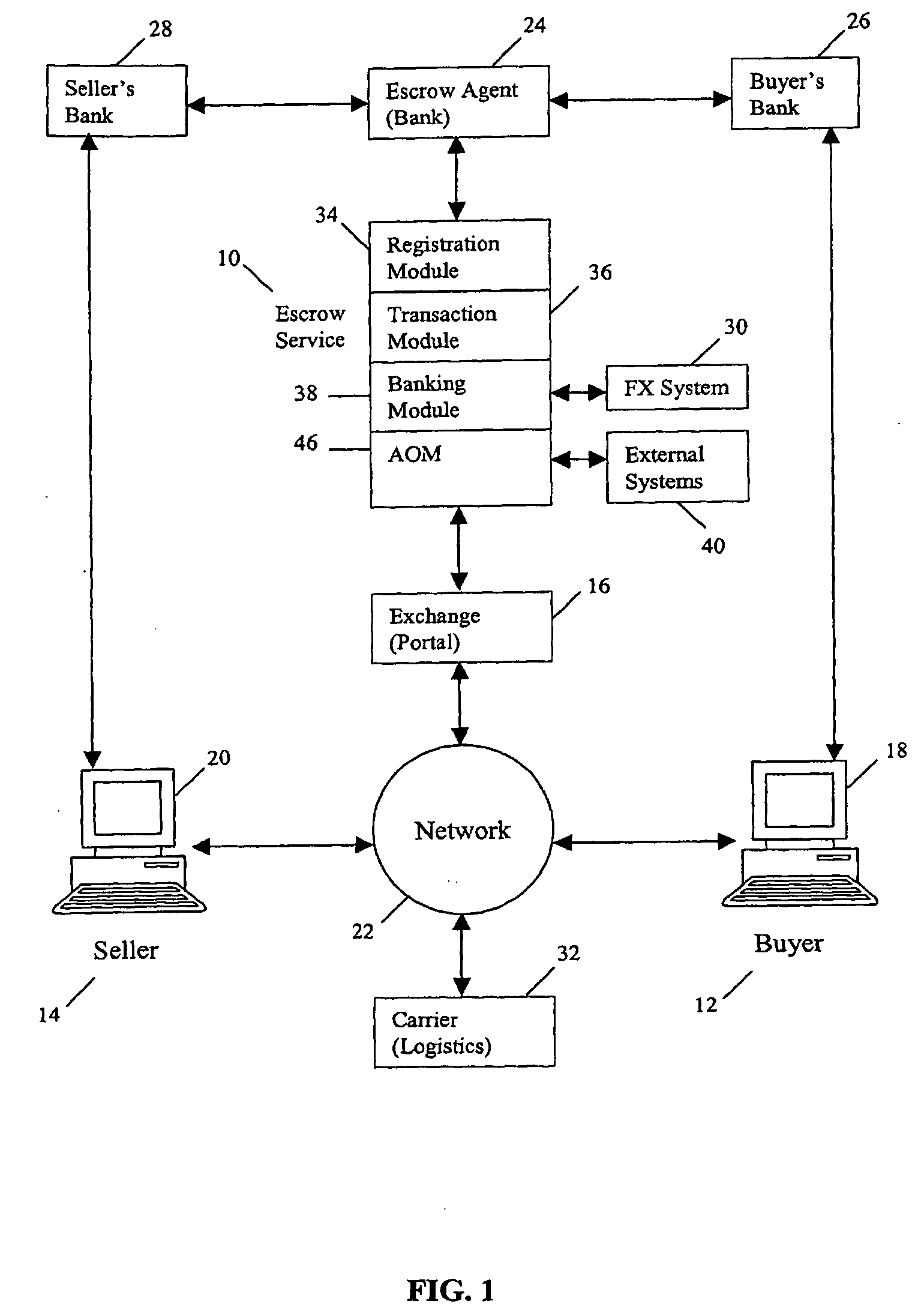

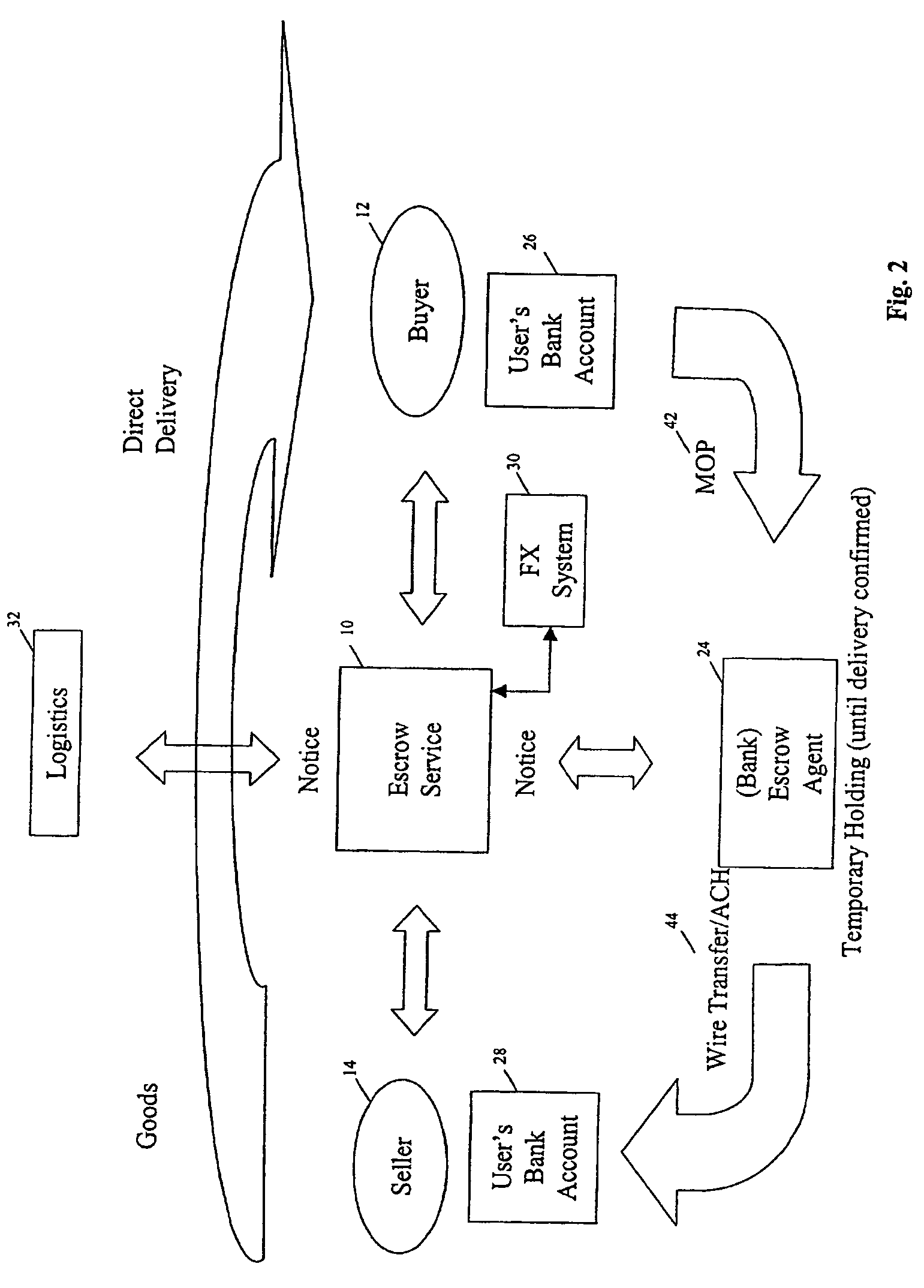

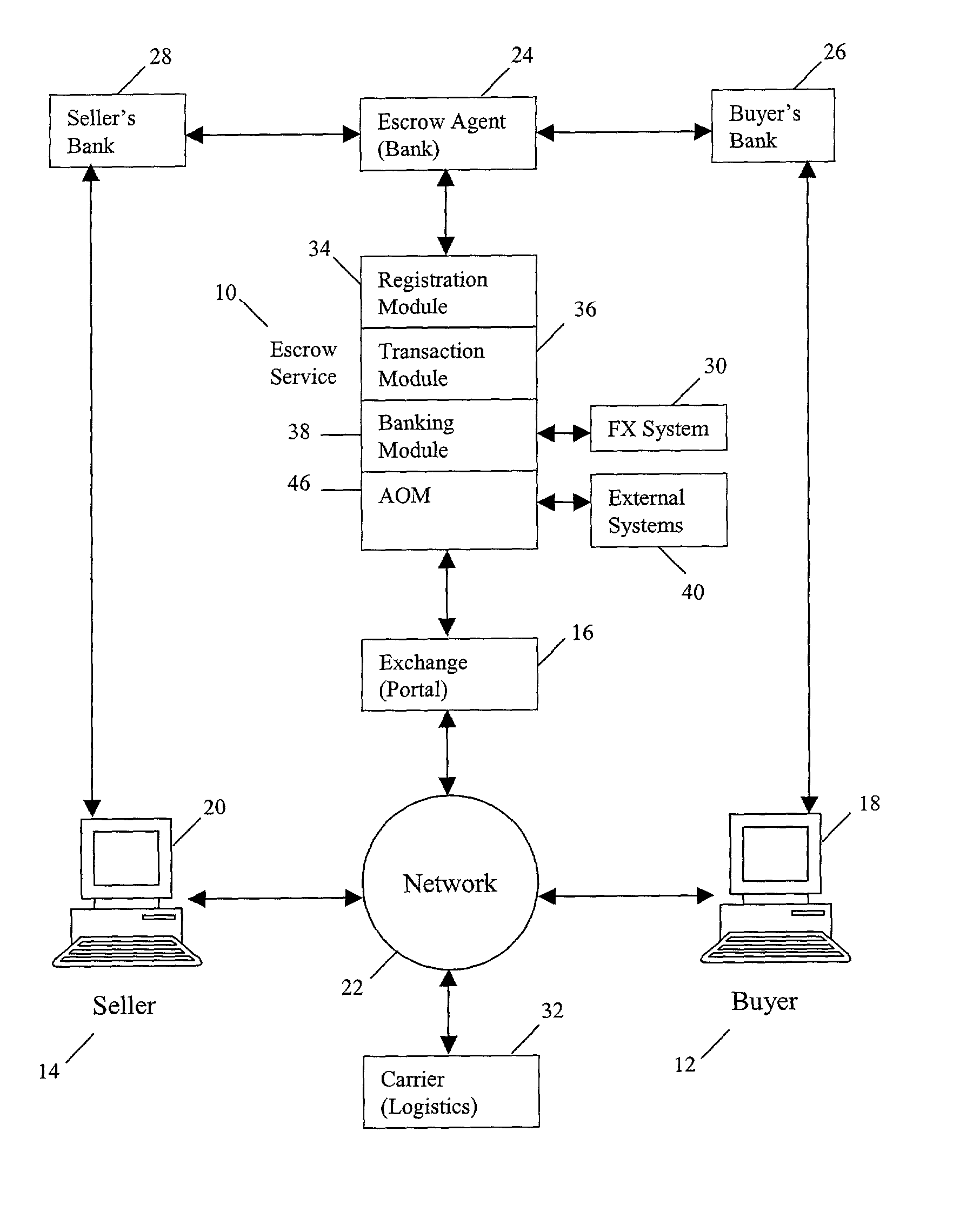

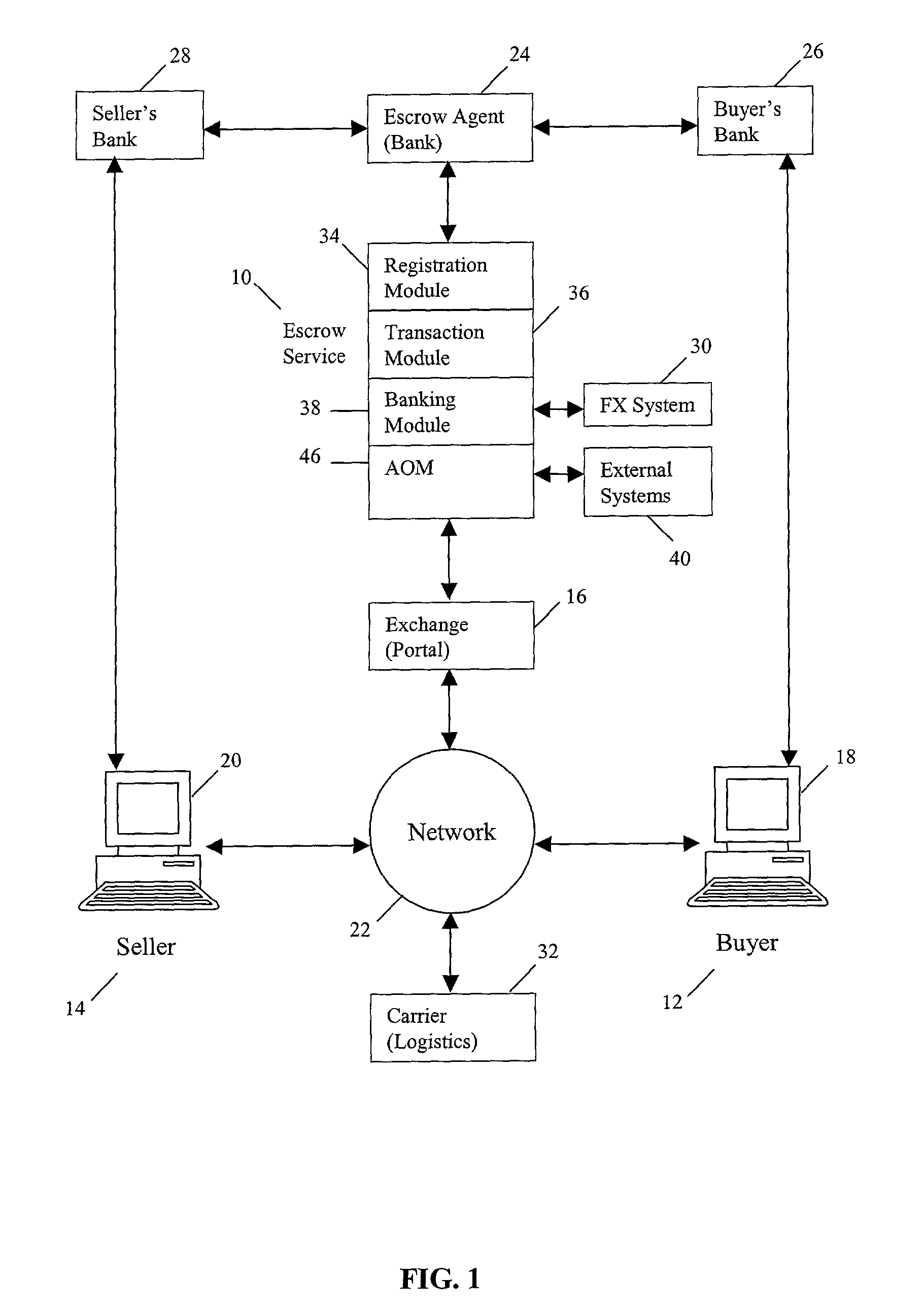

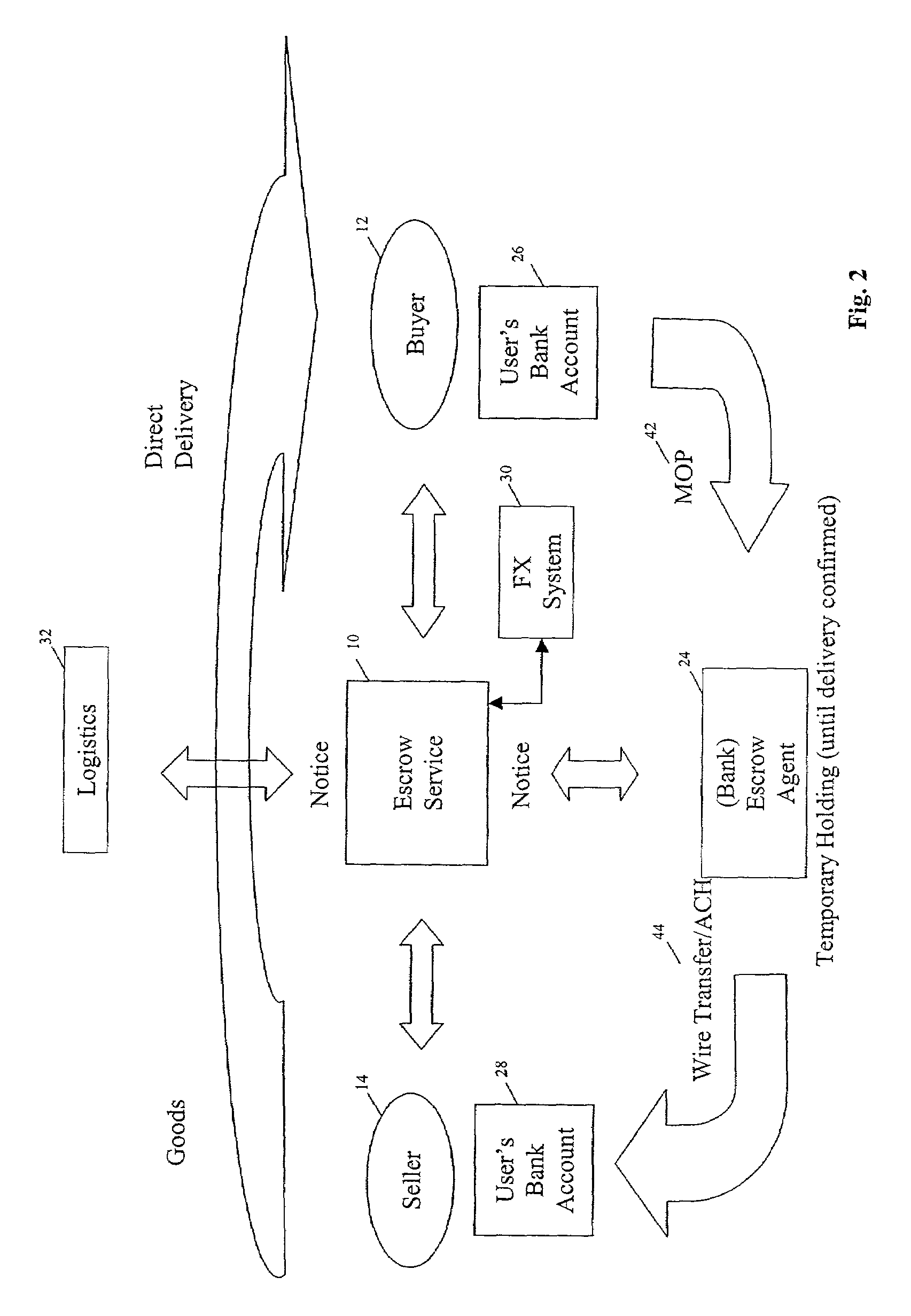

Method and system for multi-currency escrow service for web-based transactions

A method and system for escrow service for web-based transactions, such as multi-currency web-based transactions, is web-accessible and accepts registrations from exchanges and / or portal partners. The completion of registration and transactions is allowed to entitled users who access the system via the web. The system maintains an internal banking engine to act as a deal manager, messaging service and accounts sub-ledger and escrows funds entrusted to it. The transaction process is composed of a number of transaction statuses, and reporting of those statuses to users is accomplished online and via web query. The system provides local currency / multi-currency capability and supports several methods of payment, such as credit cards, authorized Automated Clearing House (ACH) or equivalent direct debit / credit and wire transfer payments, and all funds movements are electronic. The system supports transaction level detail through its banking engine accounts; funds movements from its currency accounts, and escrows funds to currency based escrow accounts. Buyers completing goods / services inspections after delivery initiate settlements.

Owner:CITIBANK

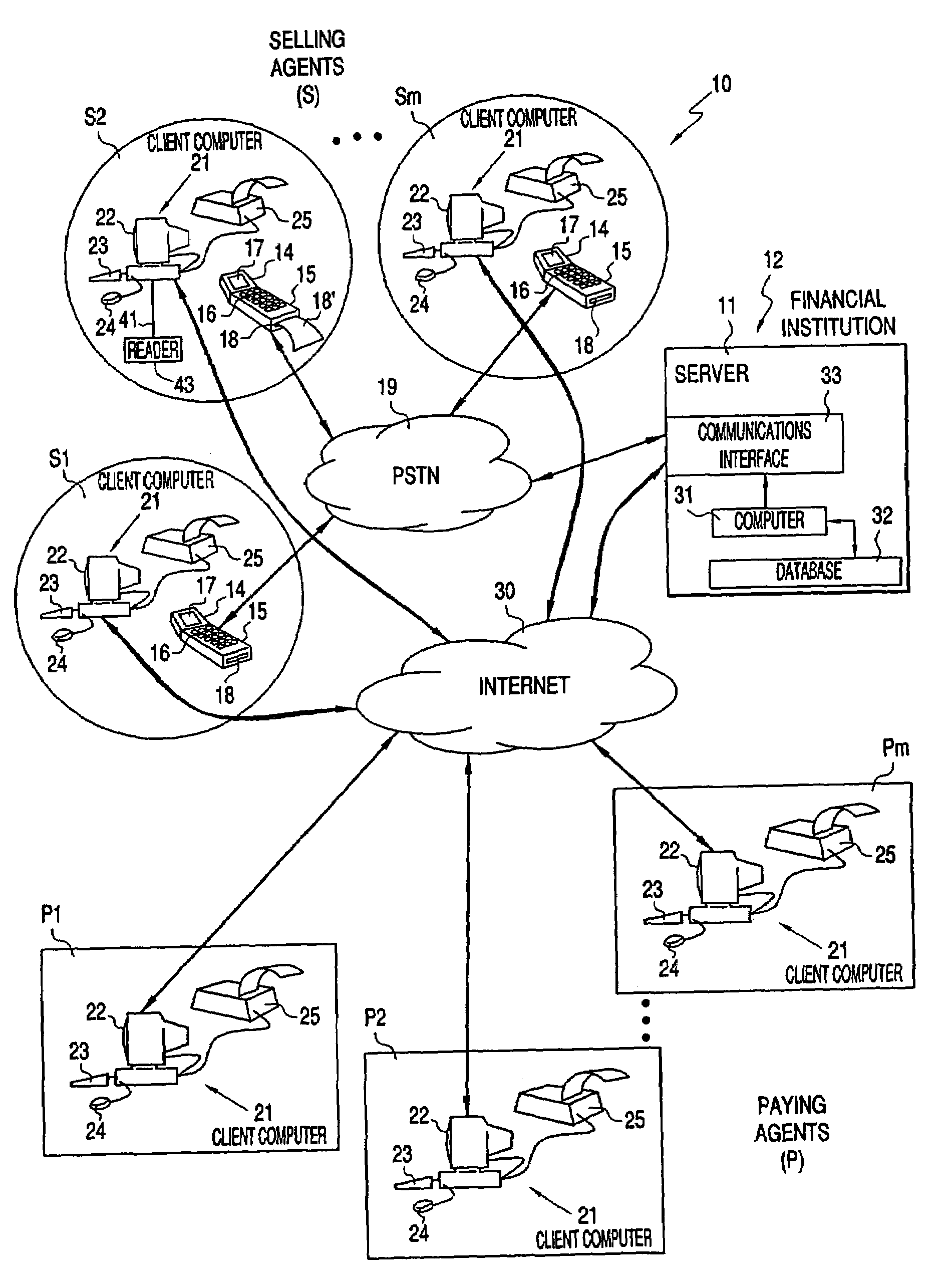

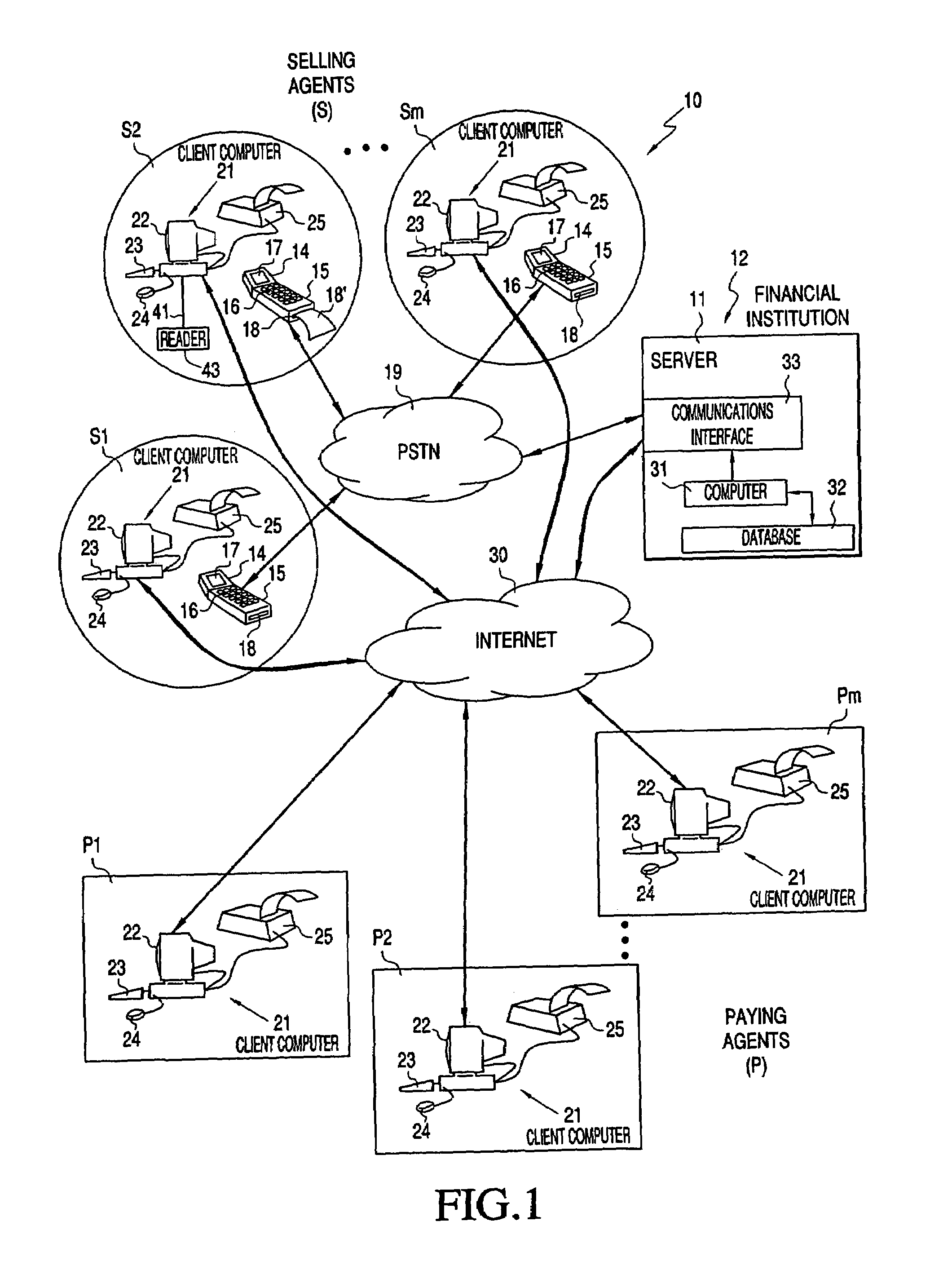

Money-transfer techniques

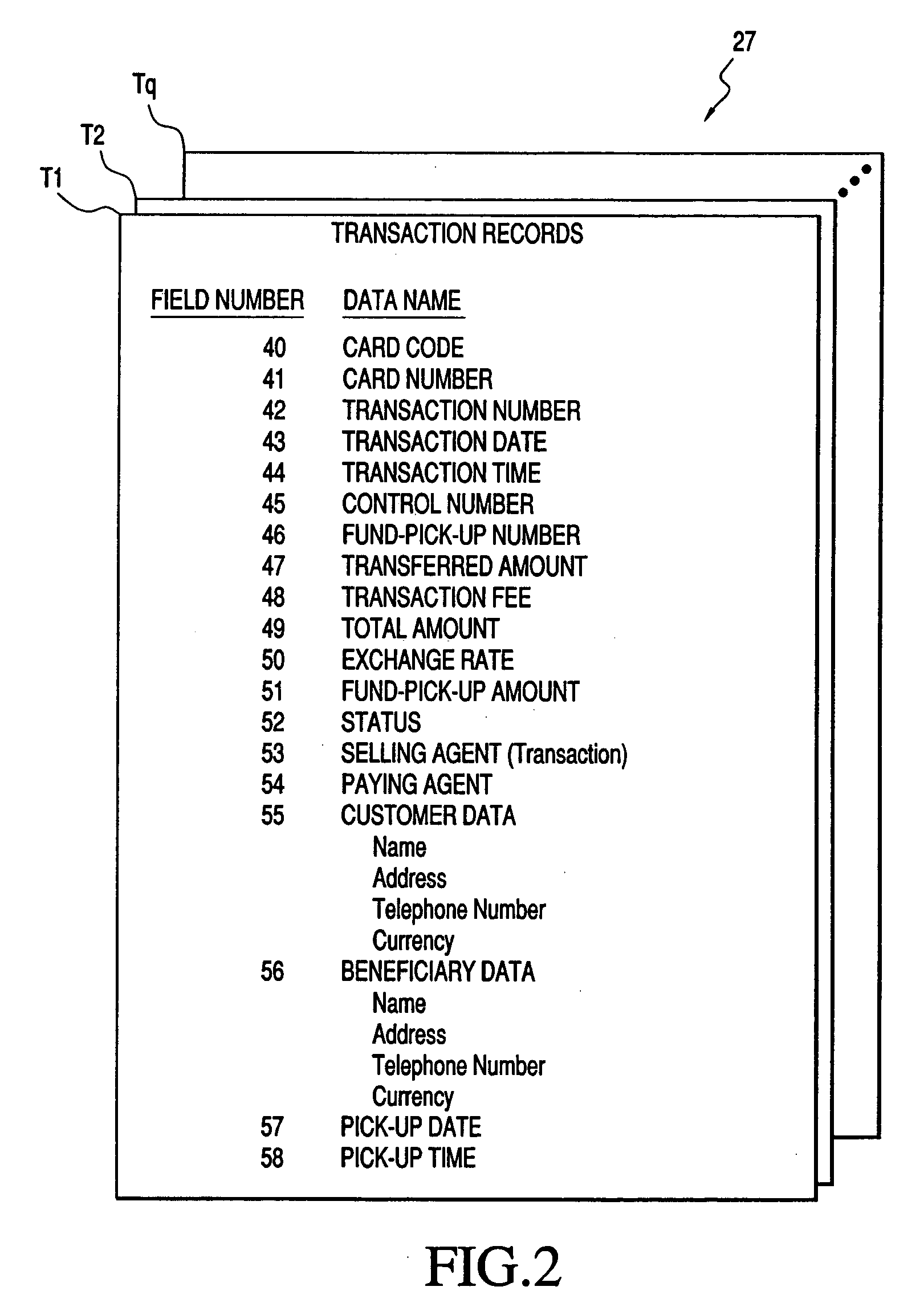

A technique for transferring money between a customer and a beneficiary comprises a money-transfer company, and a plurality of selling agents and paying agents. The money-transfer company maintains a server, a database, and a communications interface for communicating, via a telephone network and / or the Internet, with data terminals located at the selling and paying agents' sites. Customer transaction cards are distributed to customers. These cards have a visible card number and a corresponding alphanumeric card code stored in, e.g., a magnetic strip. In response to a customer's request, the money-transfer company activates the customer's transaction card by loading customer and beneficiary information into a corresponding transaction card record stored in the database. A selling agent initiates a money-transfer request from a data terminal. Specifically, the selling agent enters a monetary amount and swipes the customer's card in a magnetic strip reader located on the data terminal. Upon receiving the money amount and the customer's card code, the company creates a corresponding and unique transaction record associating the customer, his (her) card and the beneficiary, in the database and returns a fund pick-up (“folio”) number to the customer. The customer discloses the folio number to the beneficiary, who, with this number and appropriate personal identification, collects the transferred money from a paying agent. The customer can use the same transaction card to make subsequent money transfers, in any amount, to the same beneficiary.

Owner:UNITELLER FINANCIAL SERVICES

Automatic financial account processing system

InactiveUS20050038737A1Save processing timeReduce errorsComplete banking machinesFinanceDeposit accountDocumentation procedure

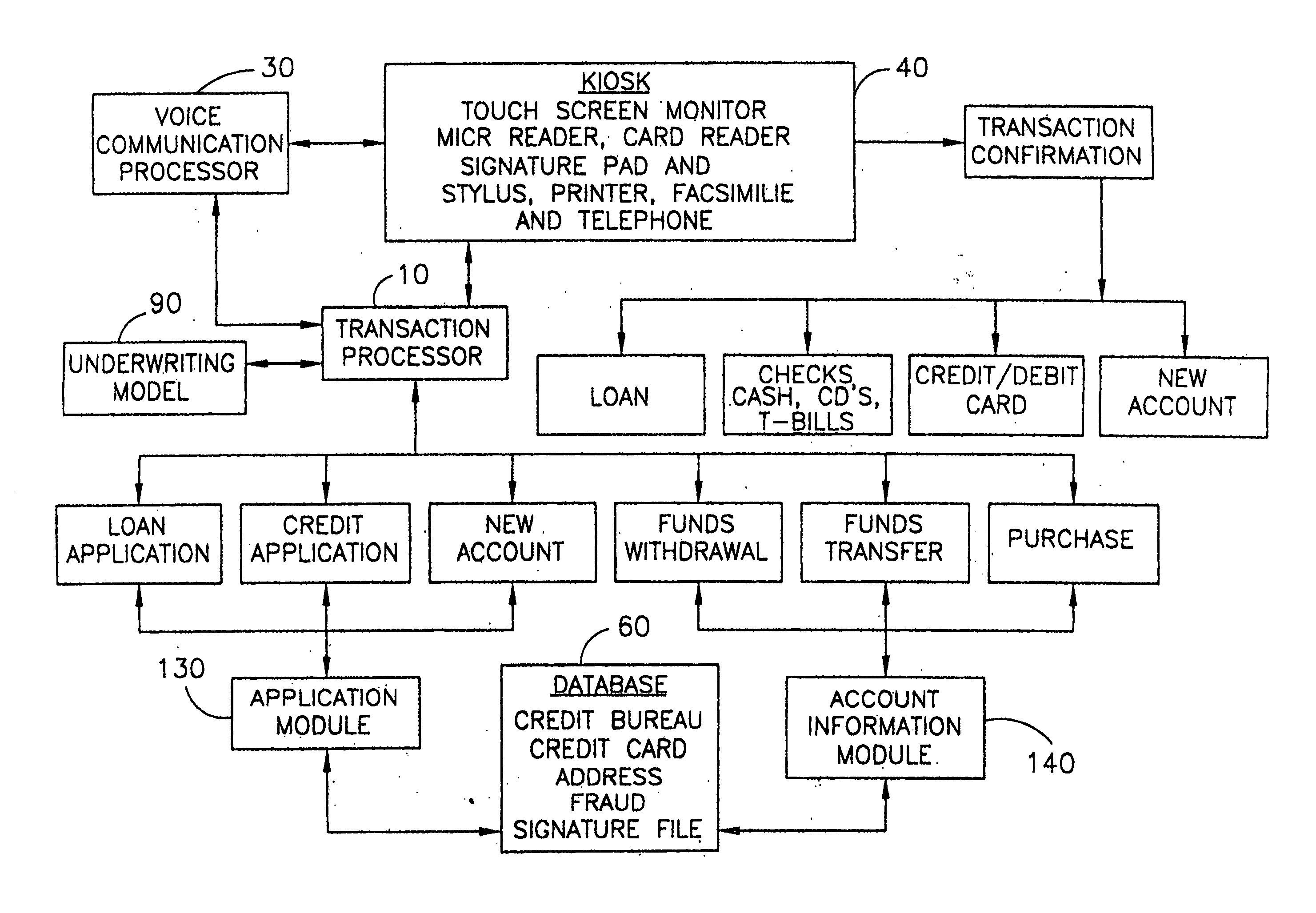

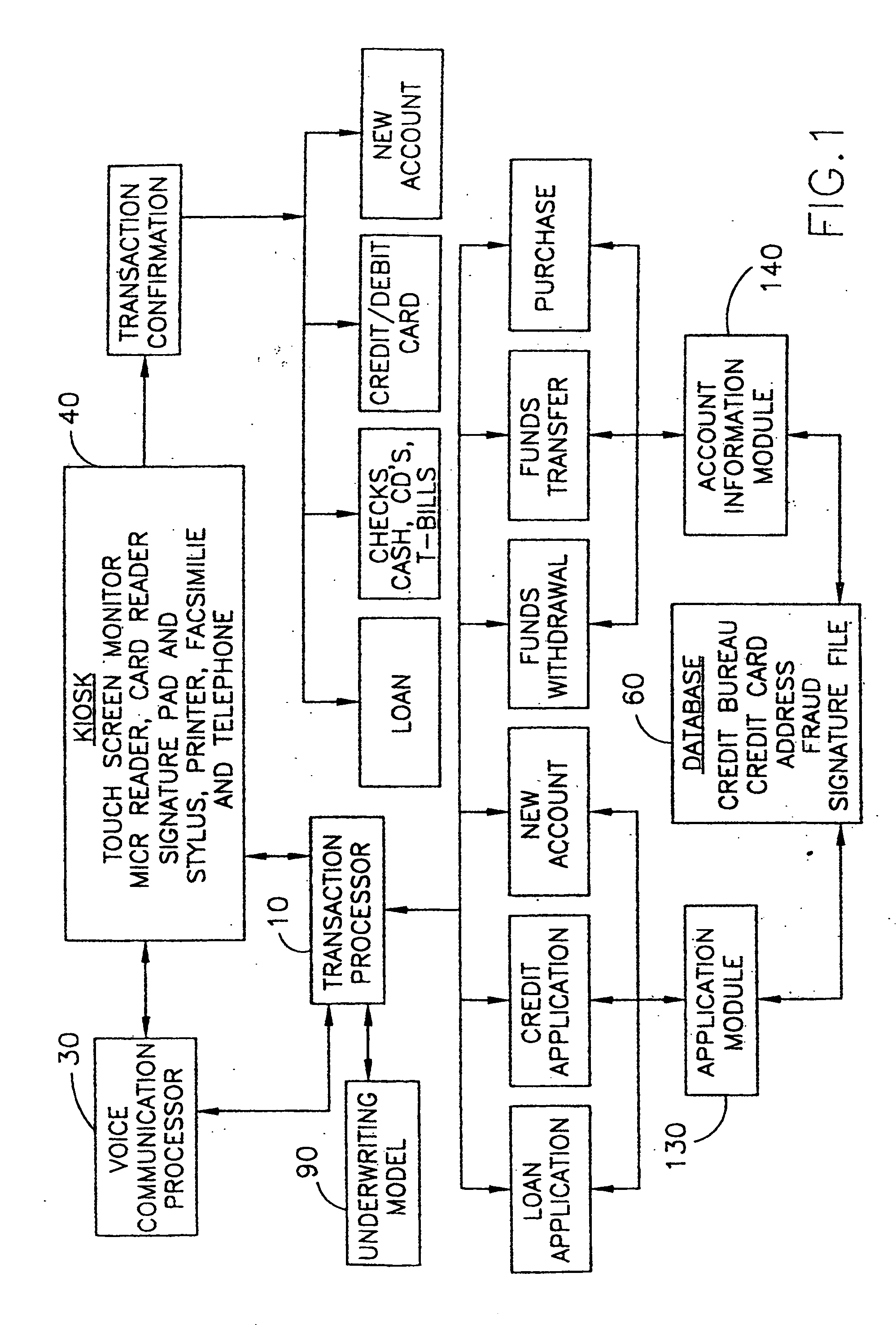

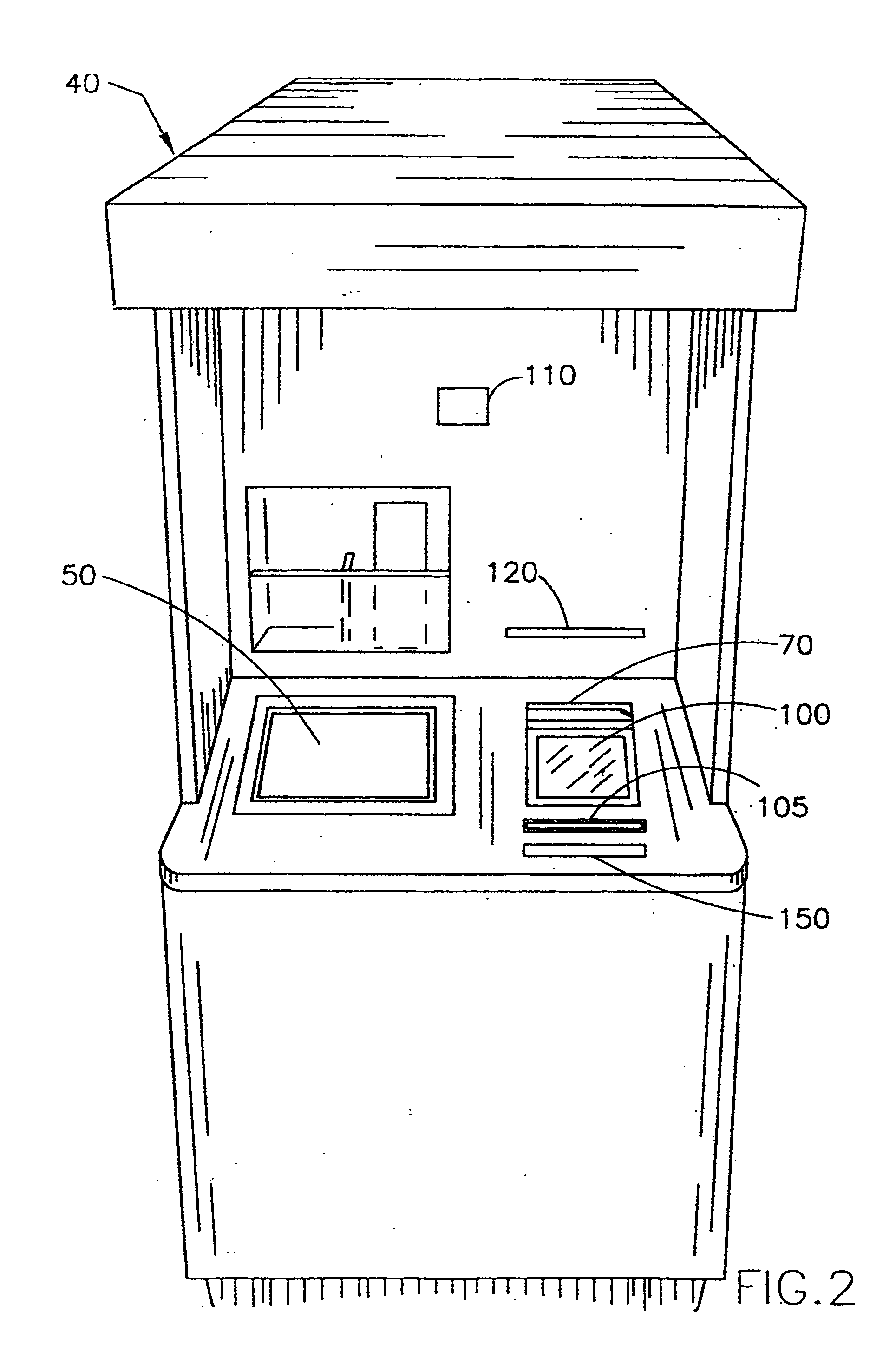

A method and apparatus for closed loop, automatic processing of typical financial transactions, including loans, setting up checking, savings and individual retirement accounts, obtaining cashier's checks, ordering additional checks, issuing credit and debit cards, wire transferring money, and so on. The transactions are provided from a kiosk and controlled by a computer controller interacting with the consumer. In the case of loans, a computer controller helps the consumer in the completion of the application, performs the underwriting, and transfers funds. The computer controller obtains the information needed to process the application, determines whether to approve the loan, effects electronic fund transfers to the applicant's deposit account, and arranges for automatic withdrawals to repay the loan. The computer controller reviews documentation requirements including consumer lending and other required documentation with the consumer and obtains acknowledgment of acceptance of terms by having the consumer sign an electronic signature pad. Copies of documents with a digital photograph are printed out by a printer in the kiosk for the consumer. Finally, the kiosk has the capability of imprinting a credit or debit card in response to a consumer request.

Owner:DECISIONING COM

System and method for providing export services to merchants

InactiveUS7853480B2Hand manipulated computer devicesPayment architectureOrder fulfillmentDocumentation procedure

A fulfillment services provider may offer export services to merchants, including generation of required export documentation; calculation, collection, and remittance of customs duties; and transportation via an international carrier. Such export services may be offered through a registration service, and may be integrated with other fulfillment services provided to registered merchants (e.g., domestic order fulfillment and / or warehousing of inventory), or may be offered to merchants that do not receive other fulfillment services from the provider. Export services may be provided to merchants who certify that all registered or specified items may be legally exported to all (or specified) international destinations, or the provider may verify compliance to export regulations on behalf of registered merchants. The provider may assume the role of Principal Party in Interest for registered merchants or the merchants may retain this role. Registration and provision of export services may be implemented in one or more software modules.

Owner:AMAZON TECH INC

Funds transfer system

InactiveUS20070124242A1Simple methodLow costFinancePayment architectureTransfer systemComputerized system

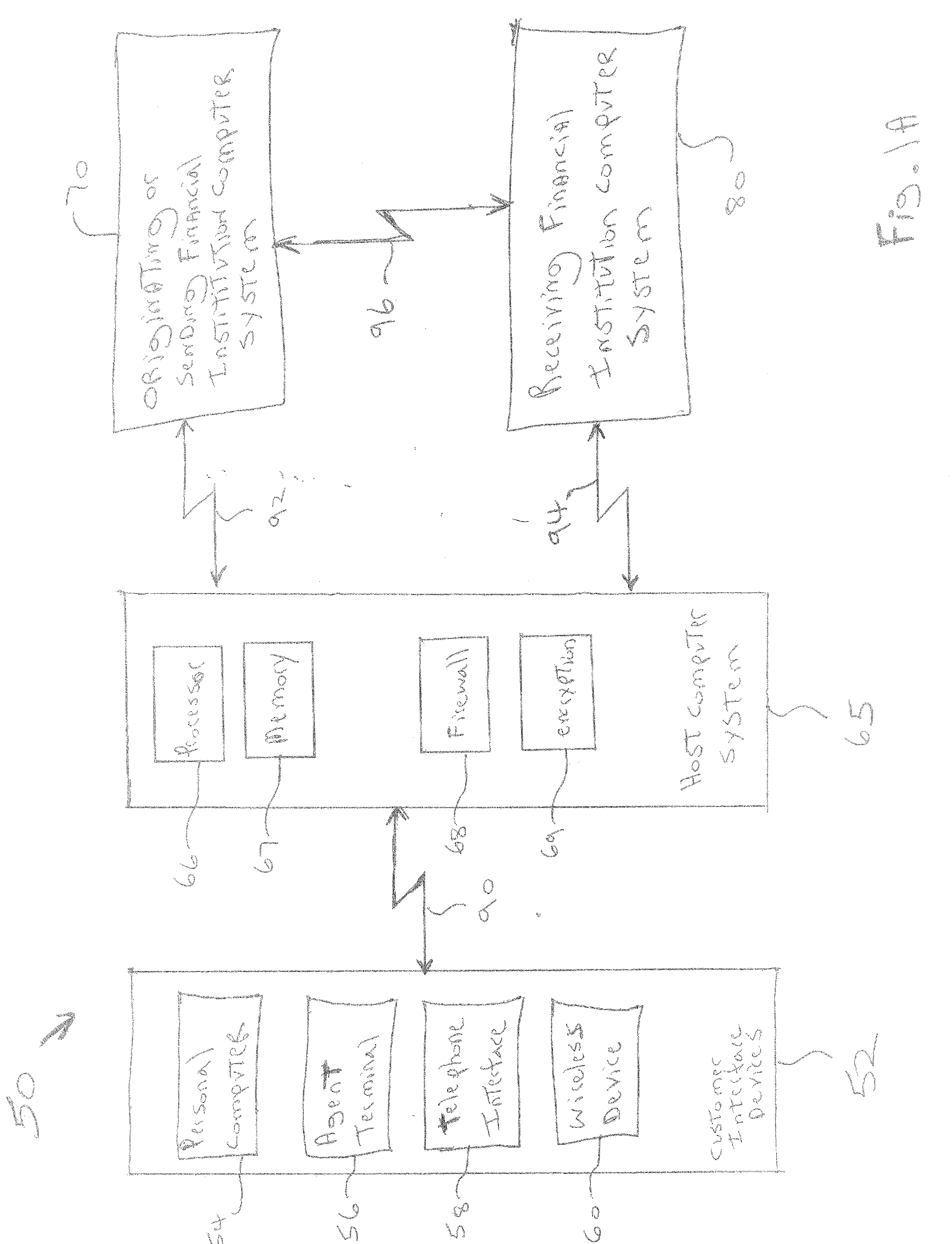

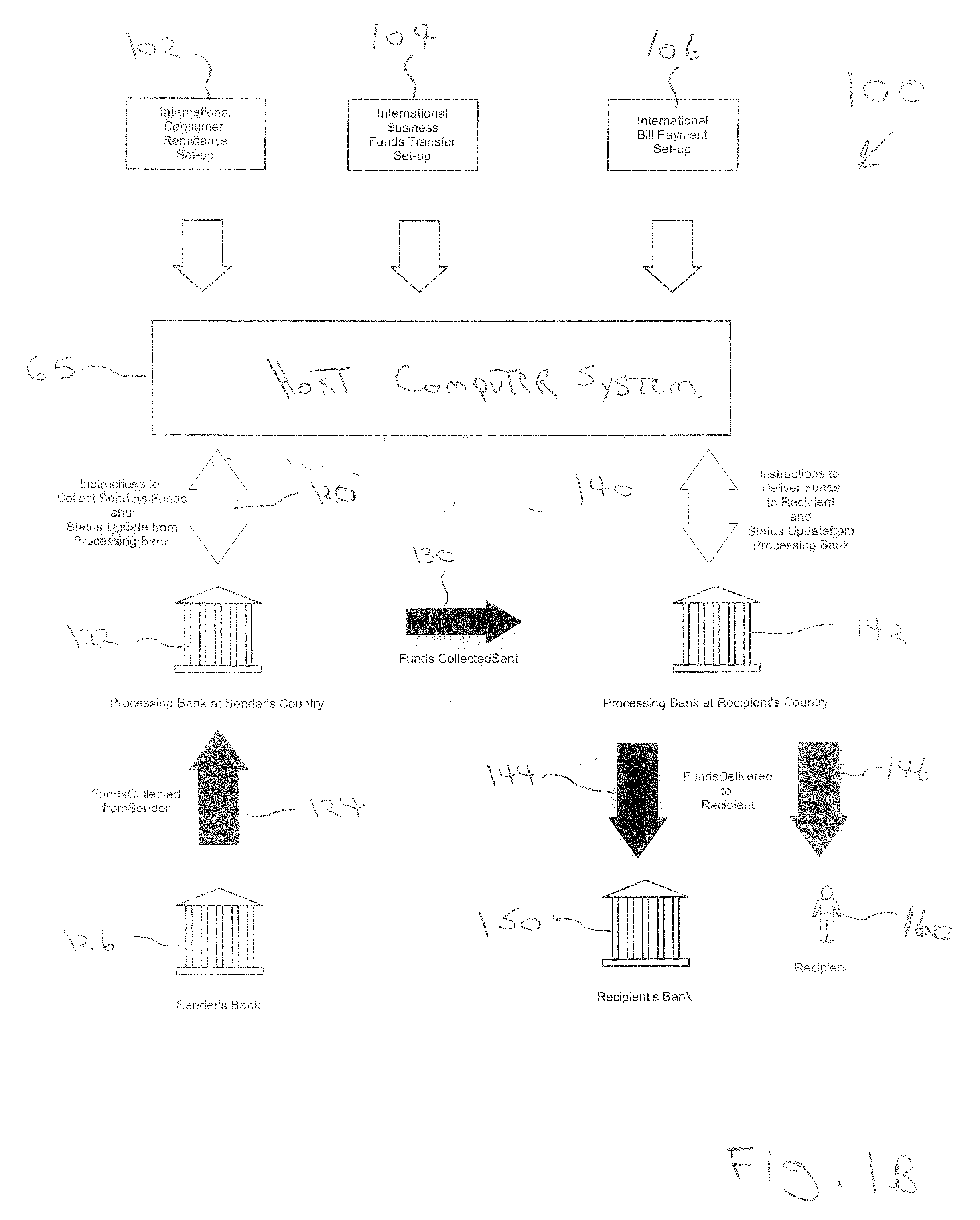

An international funds transfer system for transferring monetary funds between various countries and currencies. The funds transfer system includes a customer interface system that allows a remitter to create, validate and initiate a remittance transaction A host computer system is in communication with the customer interface system The host computer system is adapted to receive the remittance transaction from the customer interface system and to transmit the remittance transaction to an originating financial institution financial system and a receiving financial institution financial system. The originating financial institution transmits the funds to the receiving financial institution.

Owner:REIS A DENNIS JR

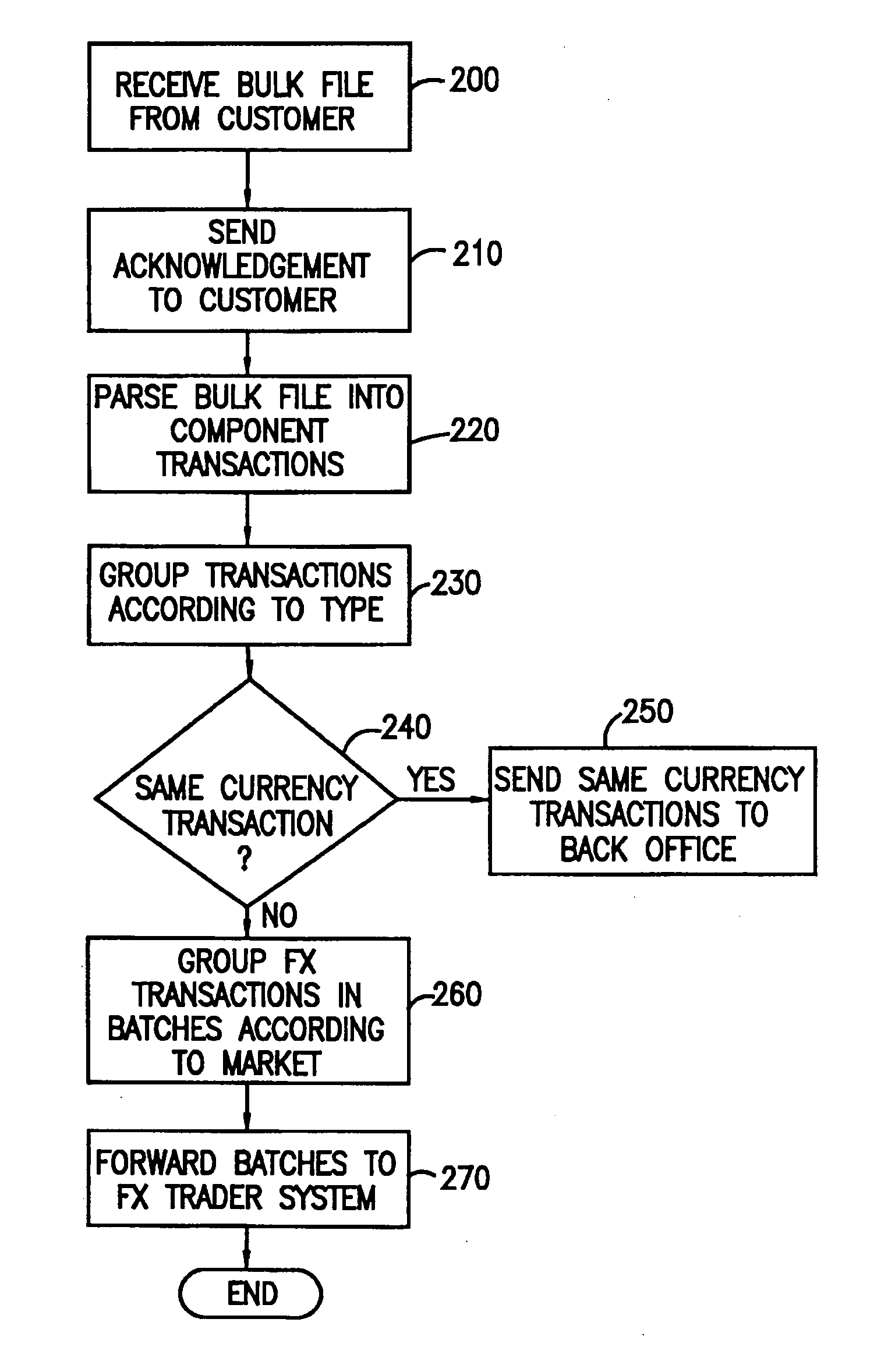

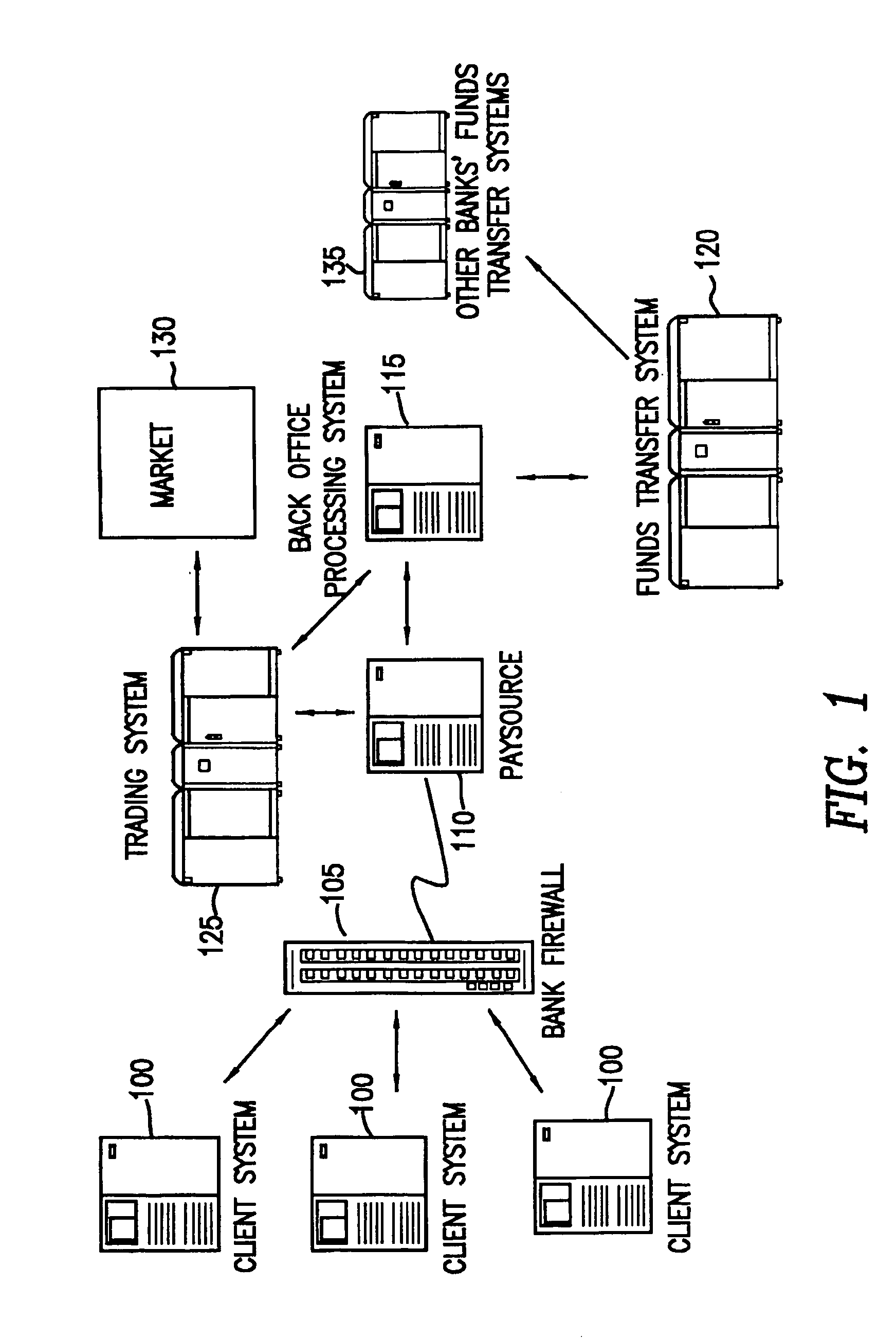

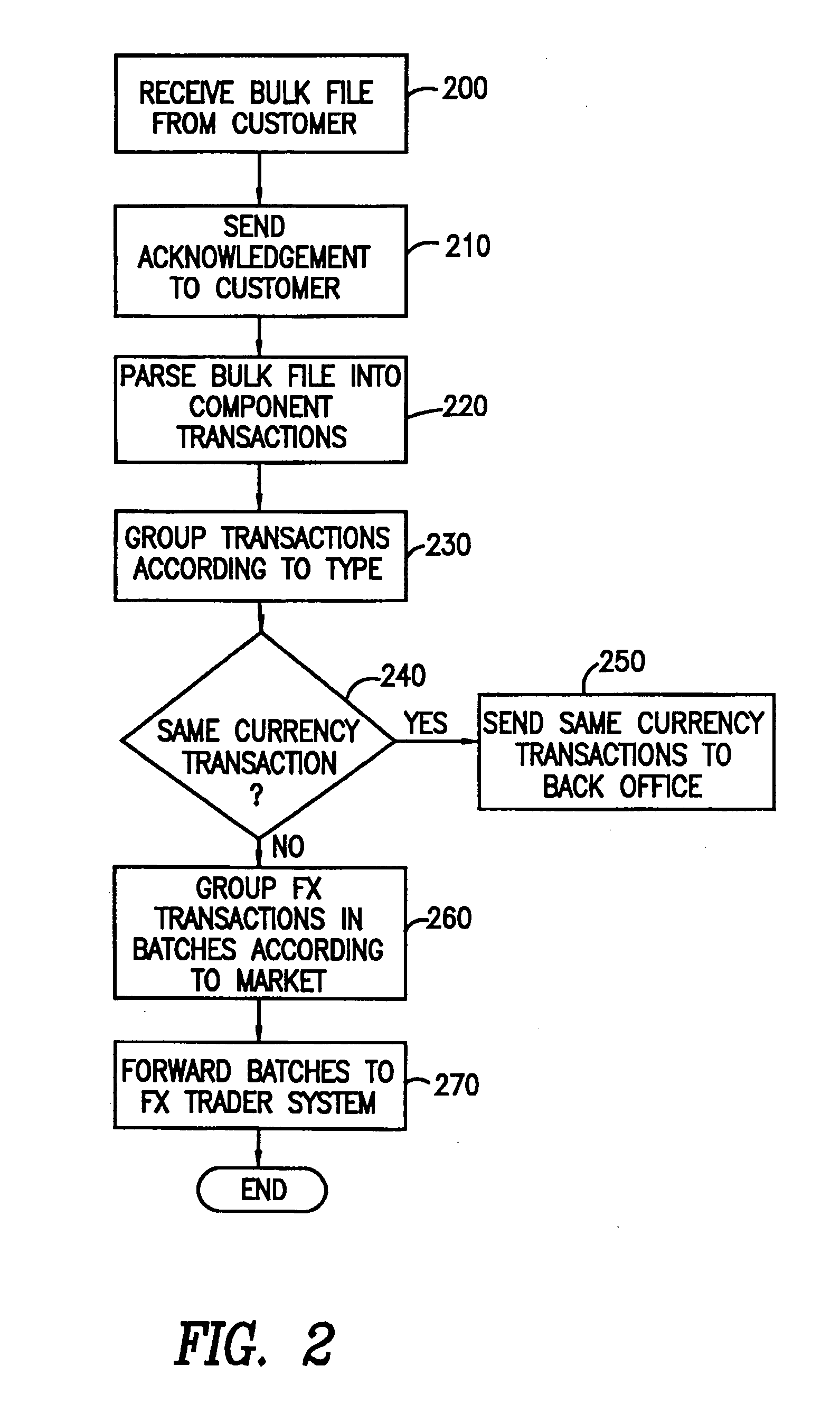

System and method for processing foreign currency payment instructions contained in bulk files

A system an method allowing customers of a banking institution to transmit bulk files of payment instructions to the bank for execution. The payment instructions may include a mix of domestic or international Automated Clearing House (ACH) transactions, domestic or international wire transfers, multibank transactions and instructions to print checks drawn on the receiving bank or at another bank. For payments requiring payment in a foreign currency in which the customer does not have an account the present invention automatically generates and executes a contract for the foreign exchange (FX) to obtain the currency required to fulfill the payment instruction. The automatic FX process can furthermore use a real time feed of foreign exchange rates as opposed to the static rates traditionally applied to such contracts.

Owner:JPMORGAN CHASE BANK NA

Method and system for multi-currency escrow service for web-based transactions

ActiveUS7464057B2Lower capability requirementsLimited accessFinanceCurrency conversionCredit cardDirect debit

A method and system for escrow service for web-based transactions is web-accessible and accepts registrations from exchanges and / or portal partners. The completion of registration and transactions is allowed to entitled users who access the system via the web. The system maintains an internal banking engine to act as a deal manager, messaging service and accounts sub-ledger and escrows funds entrusted to it. The transaction process is composed of a number of transaction statuses, and reporting of those statuses to users is accomplished online and via web query. The system supports several methods of payment, such as credit cards, authorized Automated Clearing House (ACH) or equivalent direct debit / credit and wire transfer payments, and all funds movements are electronic. The system supports transaction level detail through its banking engine accounts; funds movements from its currency accounts, and escrows funds to currency based escrow accounts. Buyers completing goods / services inspections after delivery initiate settlements.

Owner:CITIBANK

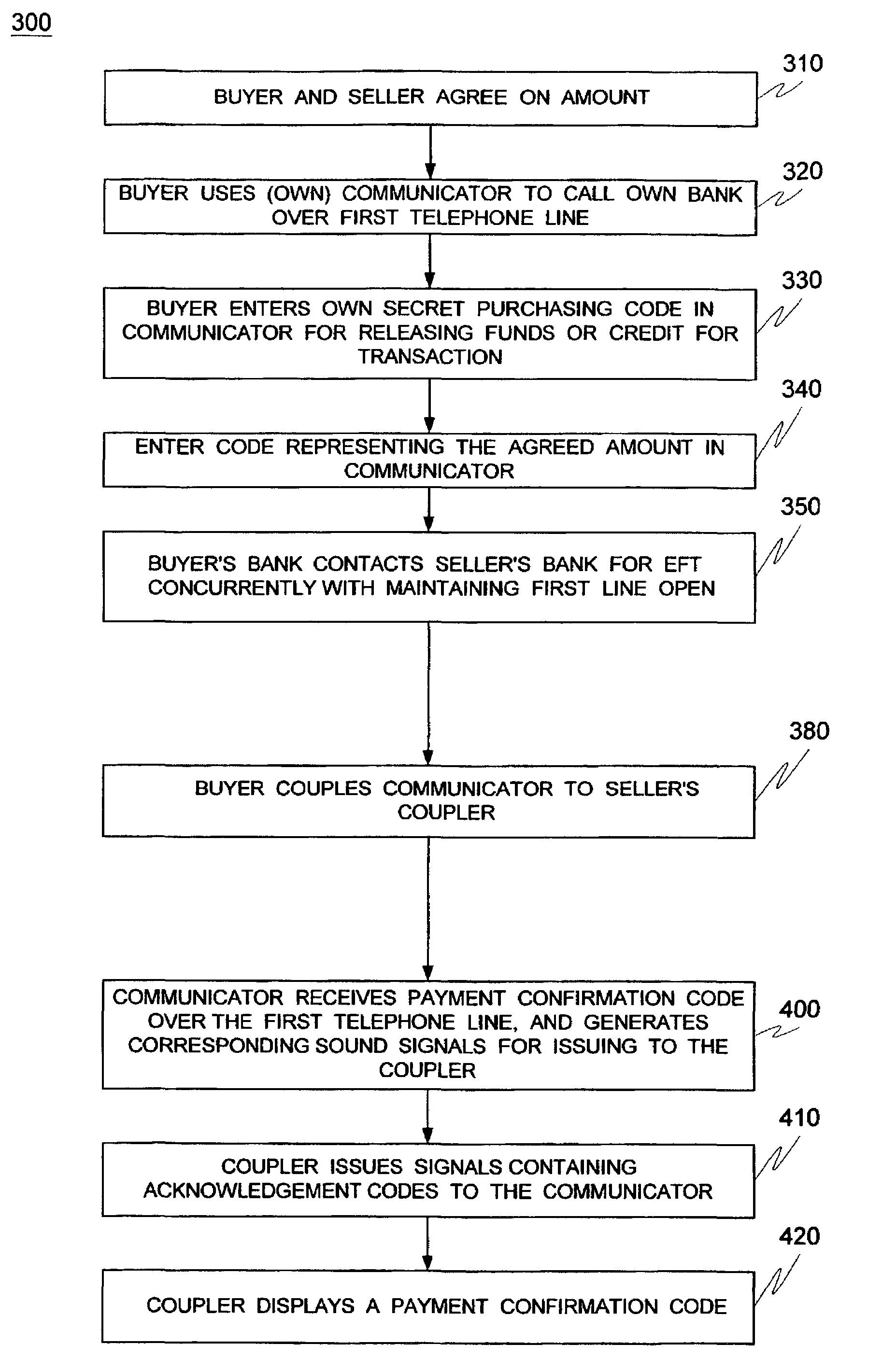

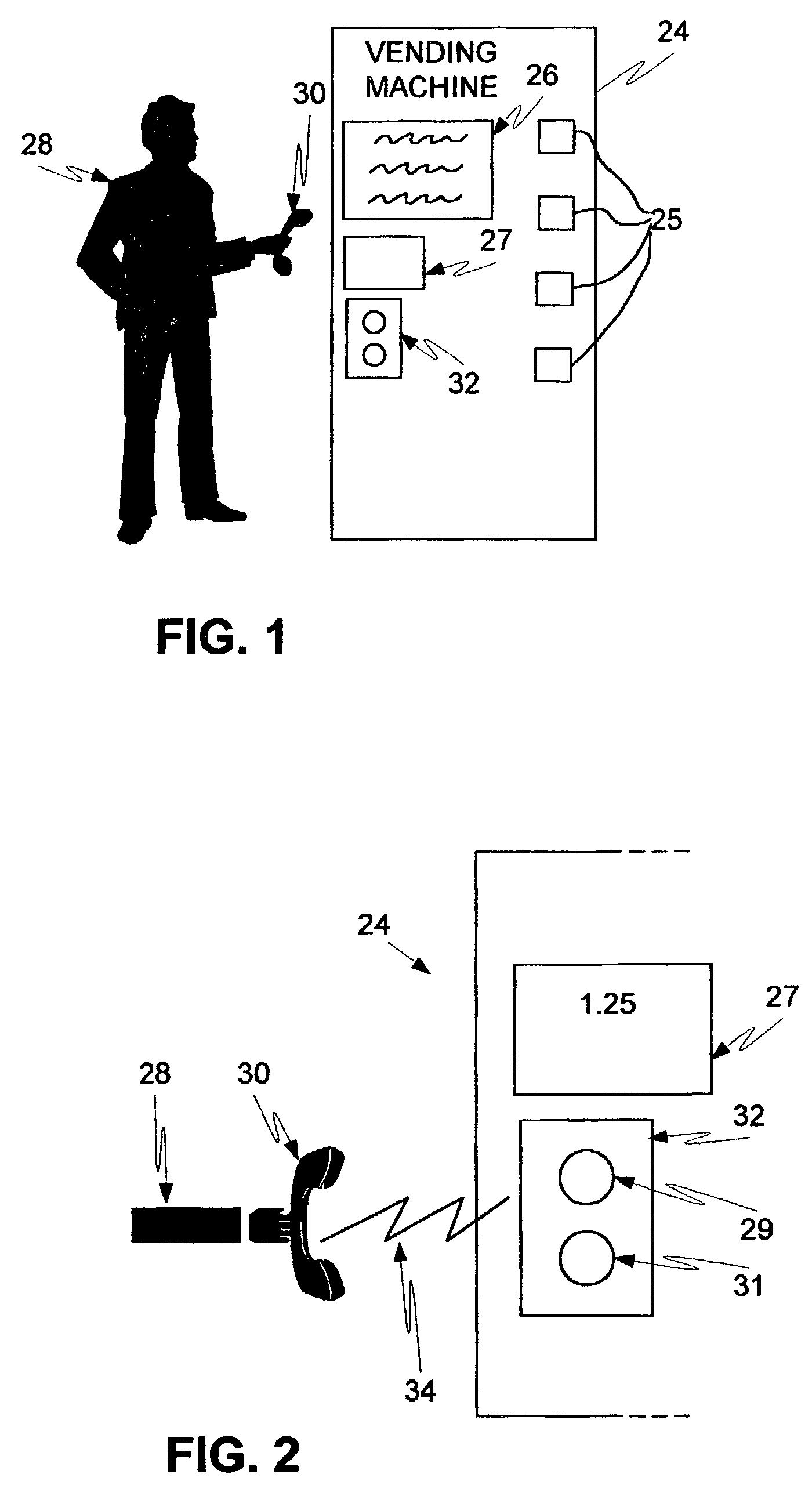

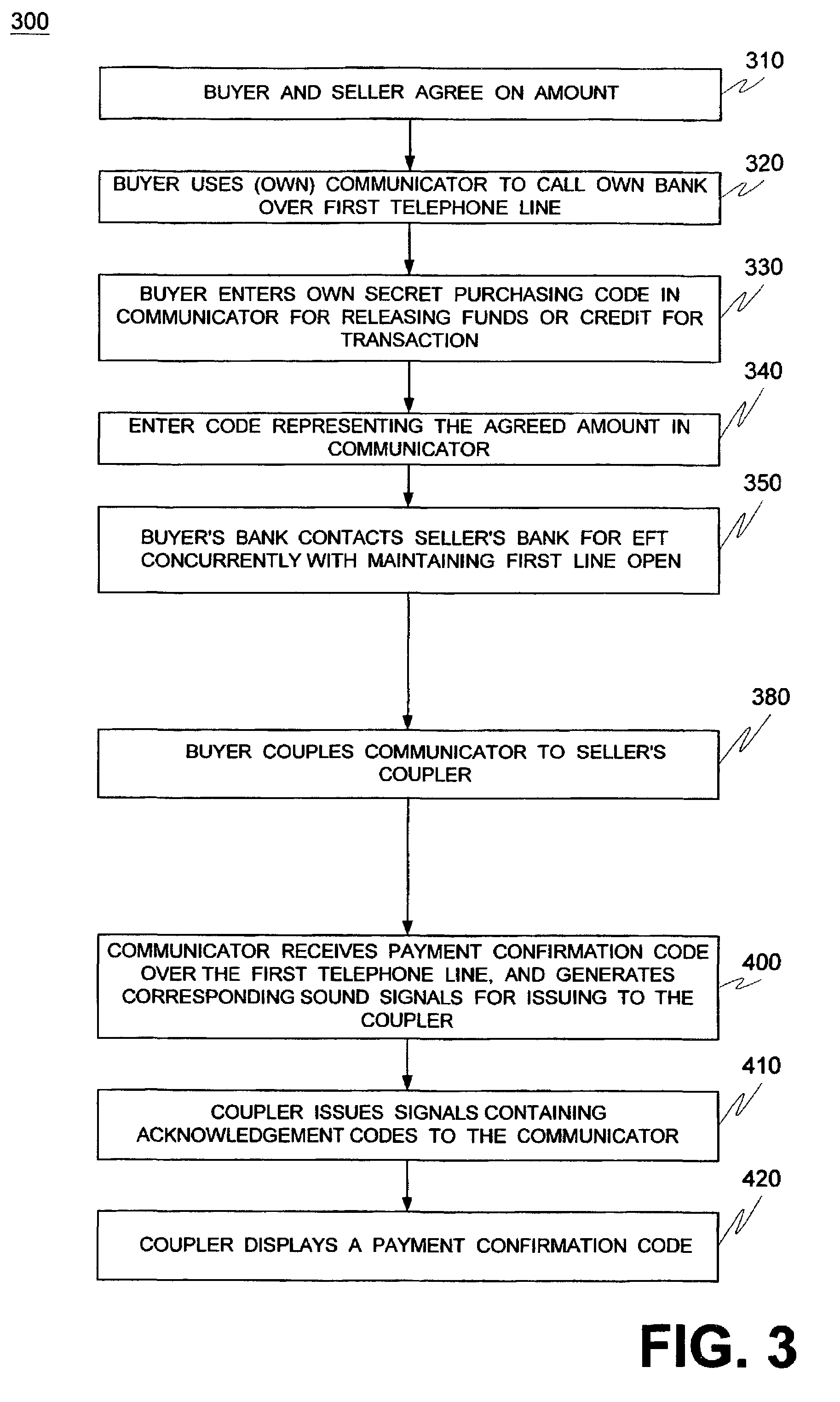

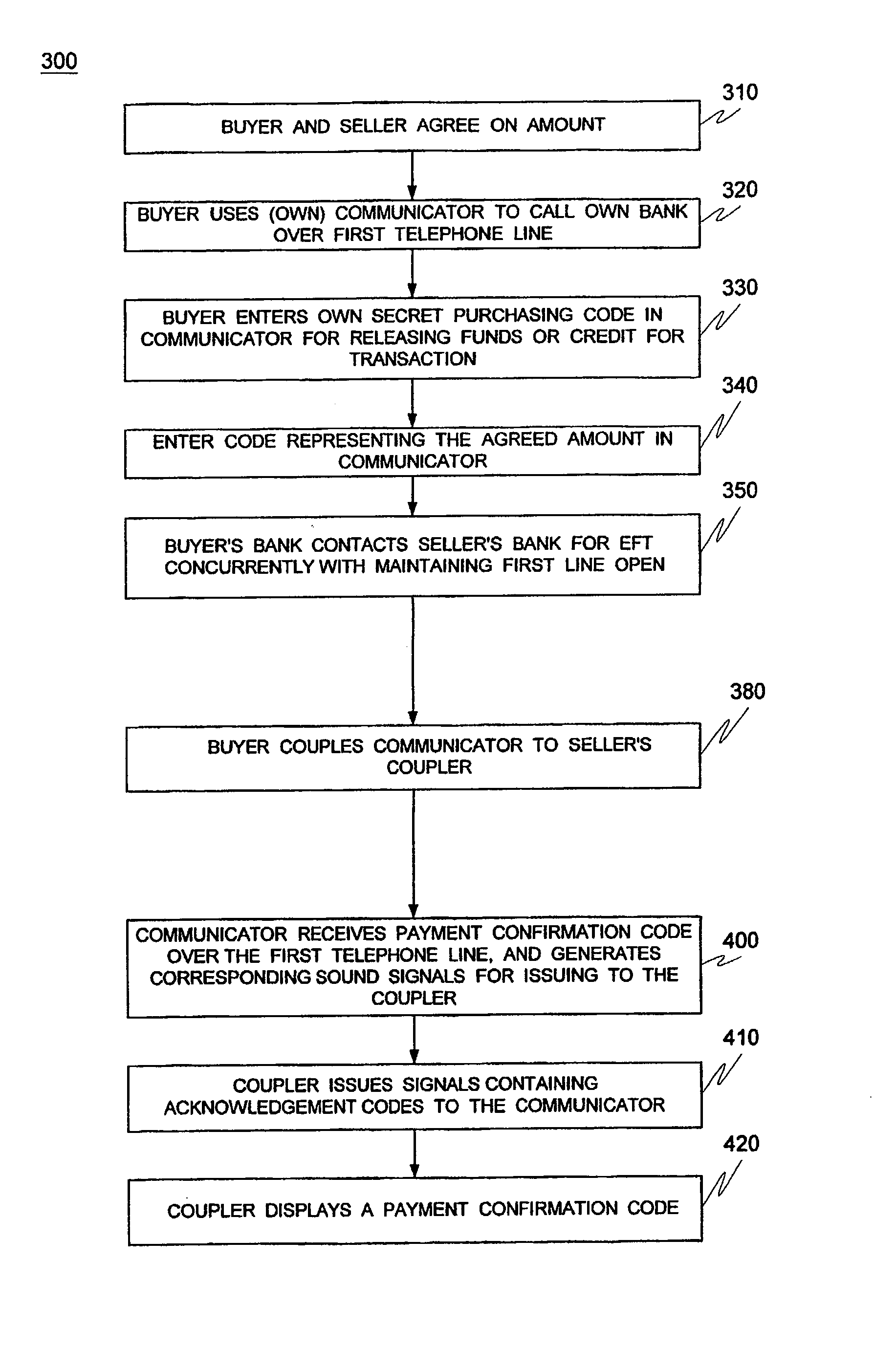

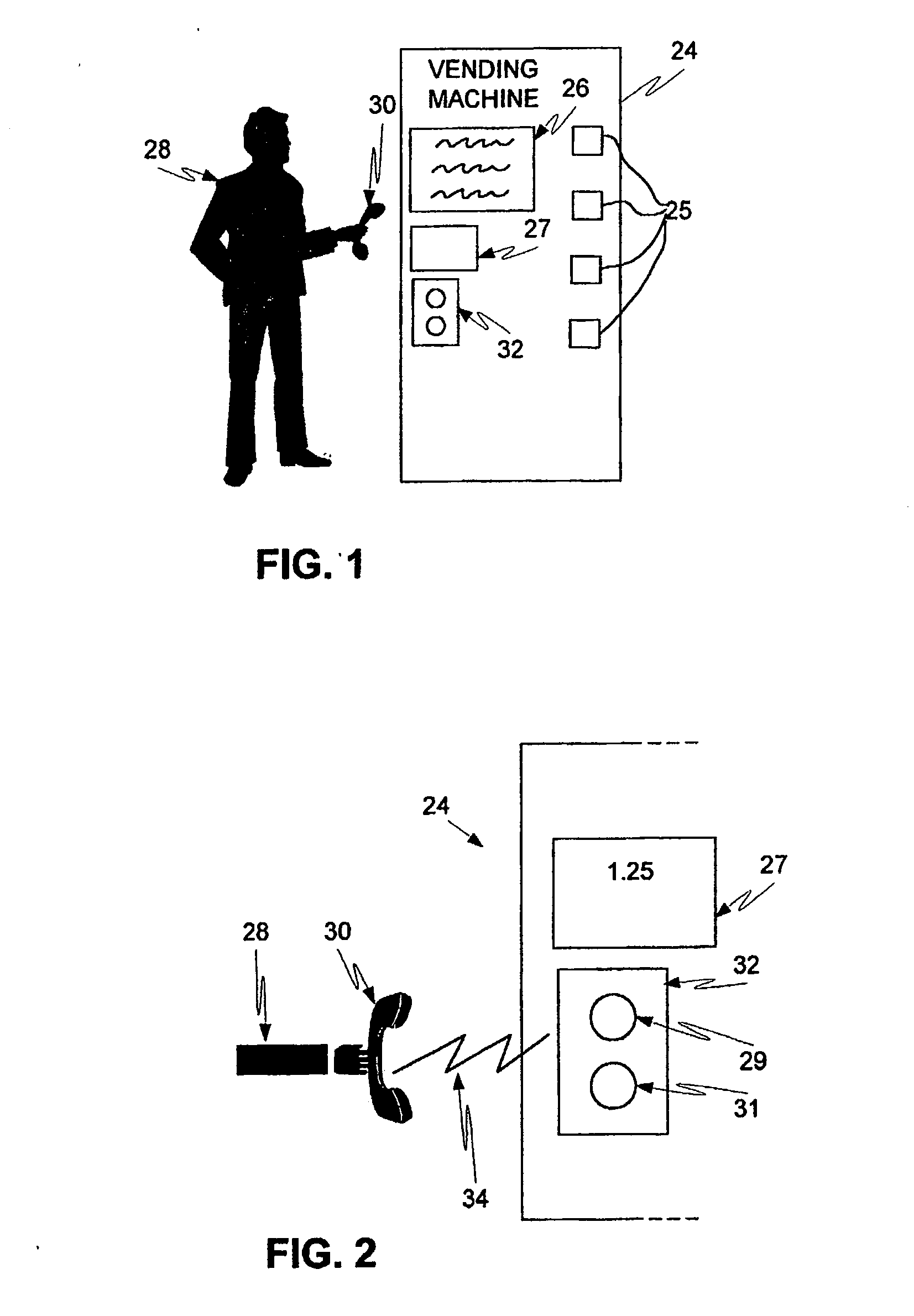

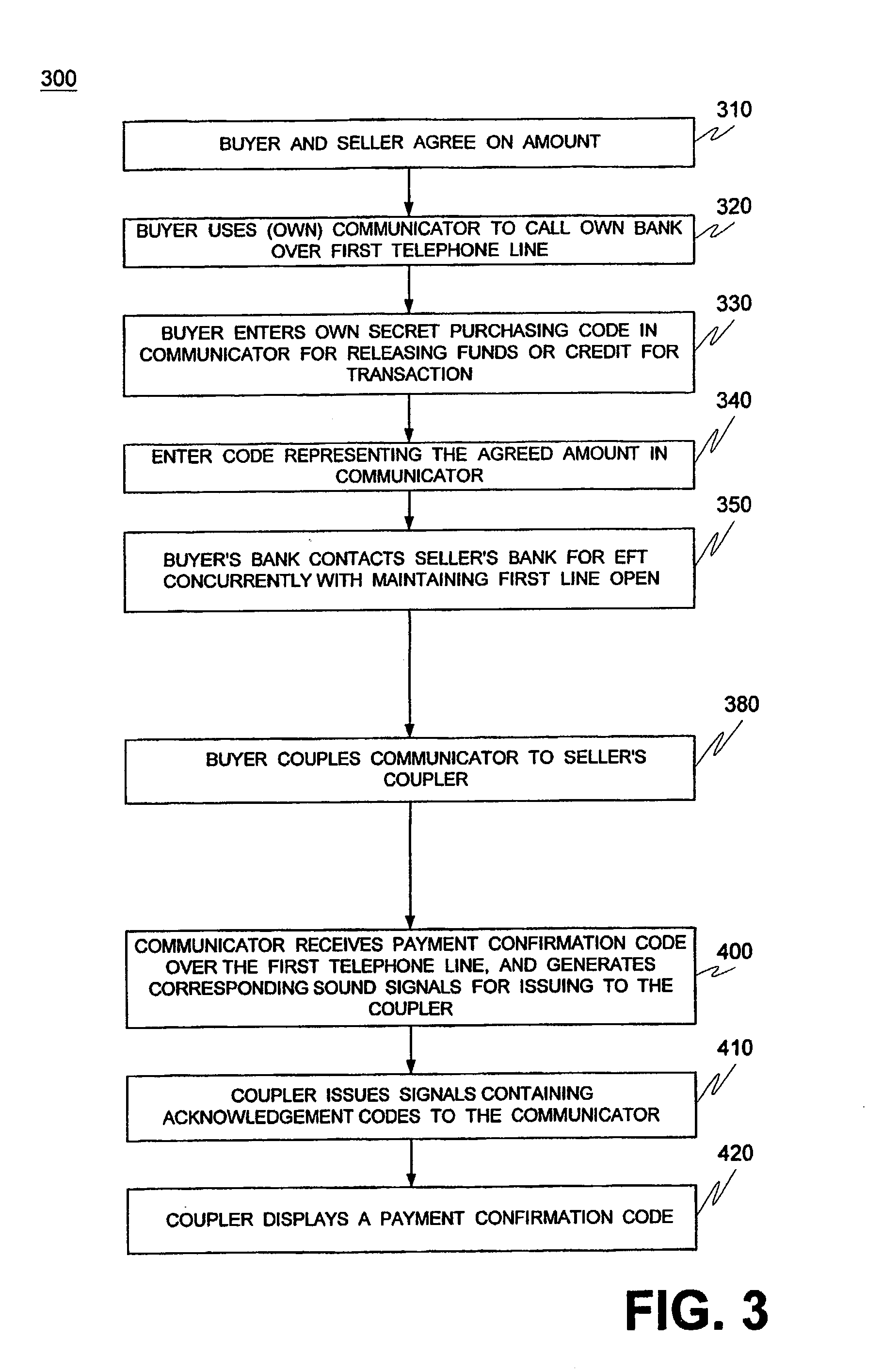

Methods, devices and bank computers for consumers using communicators to wire funds to sellers and vending machines

Methods for consumers to pay at the point of sale by using a personal communicator (30) to wire transfer funds (1364) out of their bank (40) account. The communicator (30) is coupled to, and exchanges signals with a reciprocating communicator (1350) of the seller, which in turn is coupled (1356) to the seller's bank (60). This way the money is transferred as an EFT payment code (1364) directly from the buyer's bank (40) to the seller's bank (60), where it may be considered direct deposited, without processing delays. Devices also include vending machines that can receive payment this way. Bank computers are provided with systems and software for enabling the above. The bank computers are accessible by telephone lines, and work with cooperating banks by exchanging signals, for transferring the funds. The seller's bank (60) generates a payment confirmation code (1368) that is ultimately transmitted to the seller's satisfaction for releasing the goods at the point of sale.

Owner:XYLON LLC

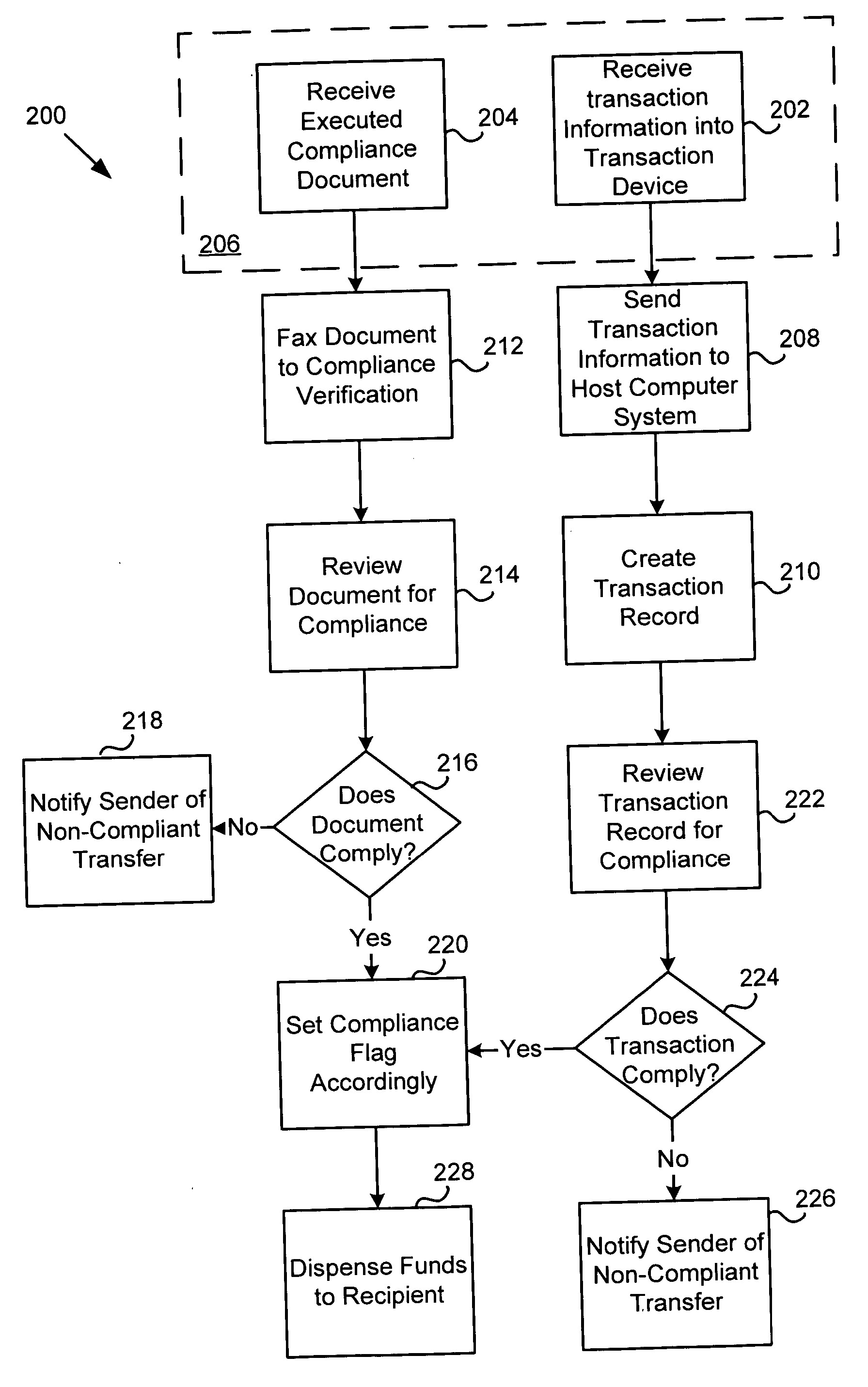

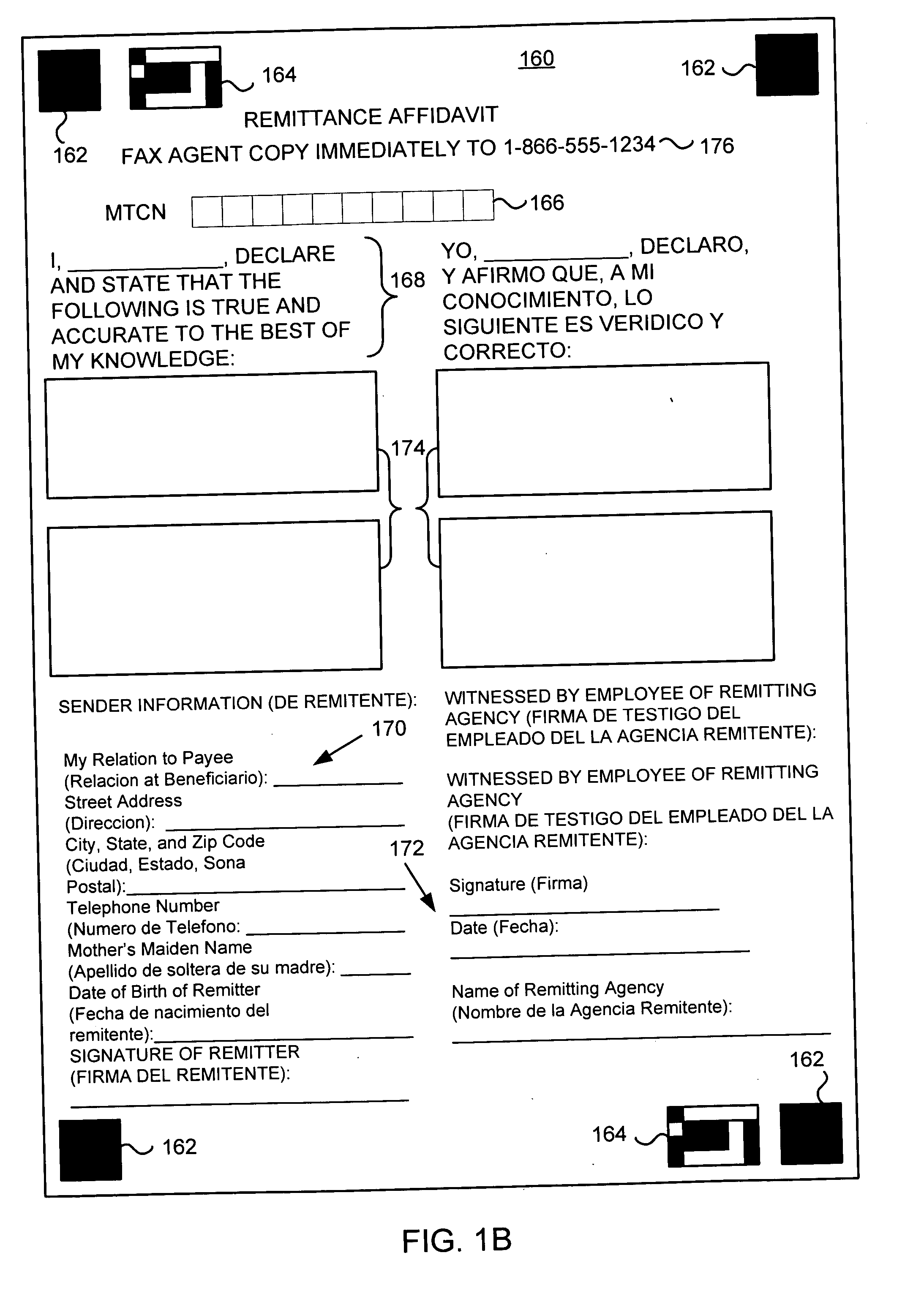

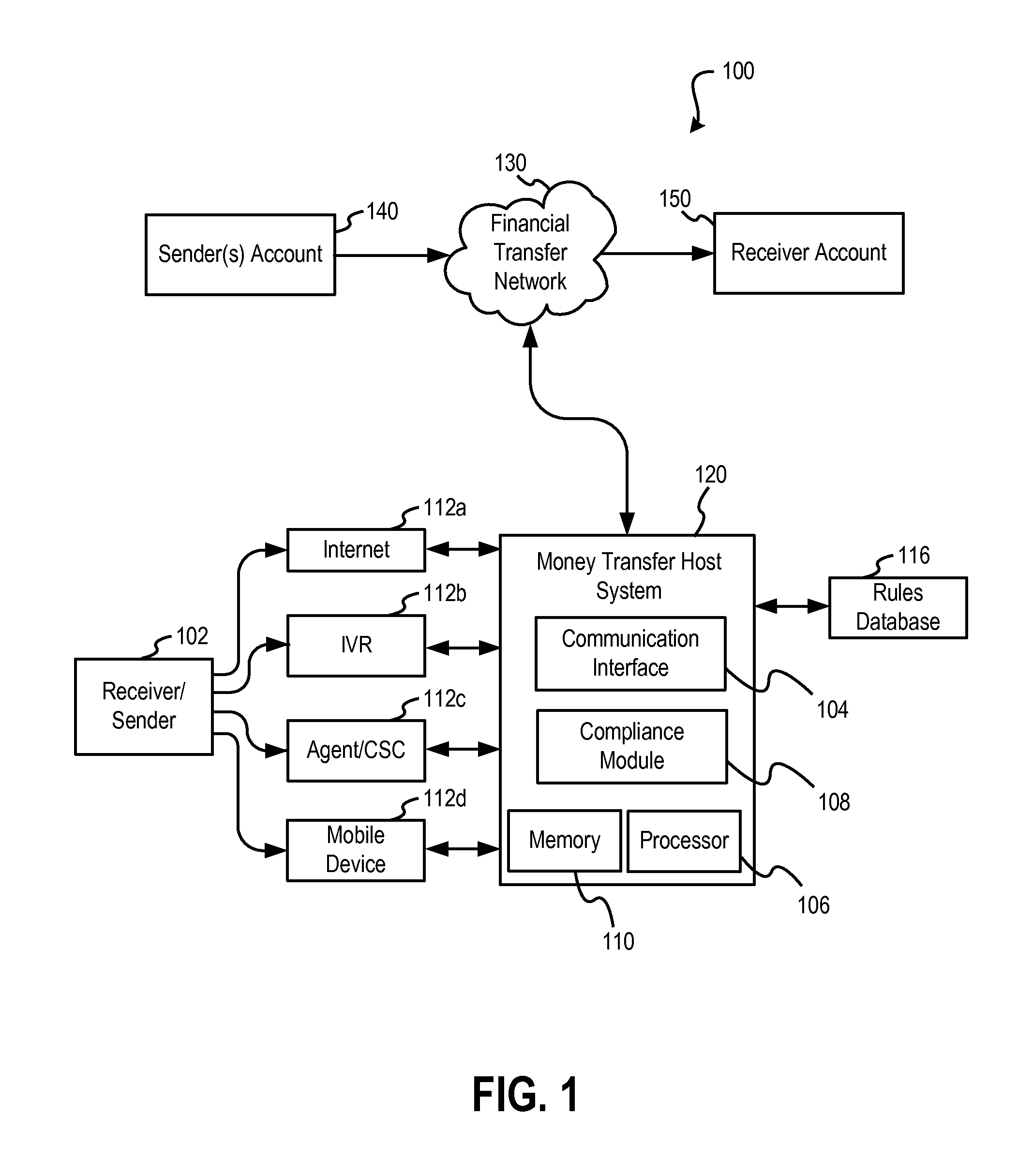

Regulated wire transfer compliance systems and methods

A method of facilitating a money transfer to a region for which compliance with a requirement requires execution of a document. The method includes receiving transaction information at a host computer system from a transaction processing device at a transaction origination location. The transaction information relates to a money transfer to the region. The method also includes storing at least a portion of the transaction information as a money transfer record. The record includes a field whose value indicates the status of compliance with the requirement. The method also includes receiving an image of at least a portion of the document, evaluating the document to determine whether the document evidences compliance with the requirement, setting the value of the field to indicate compliance with the requirement, and completing the money transfer, upon request or a recipient, if the value of the field indicates compliance with the requirement.

Owner:THE WESTERN UNION CO

Funds Transfer Method and Apparatus

Owner:CASHEDGE INC

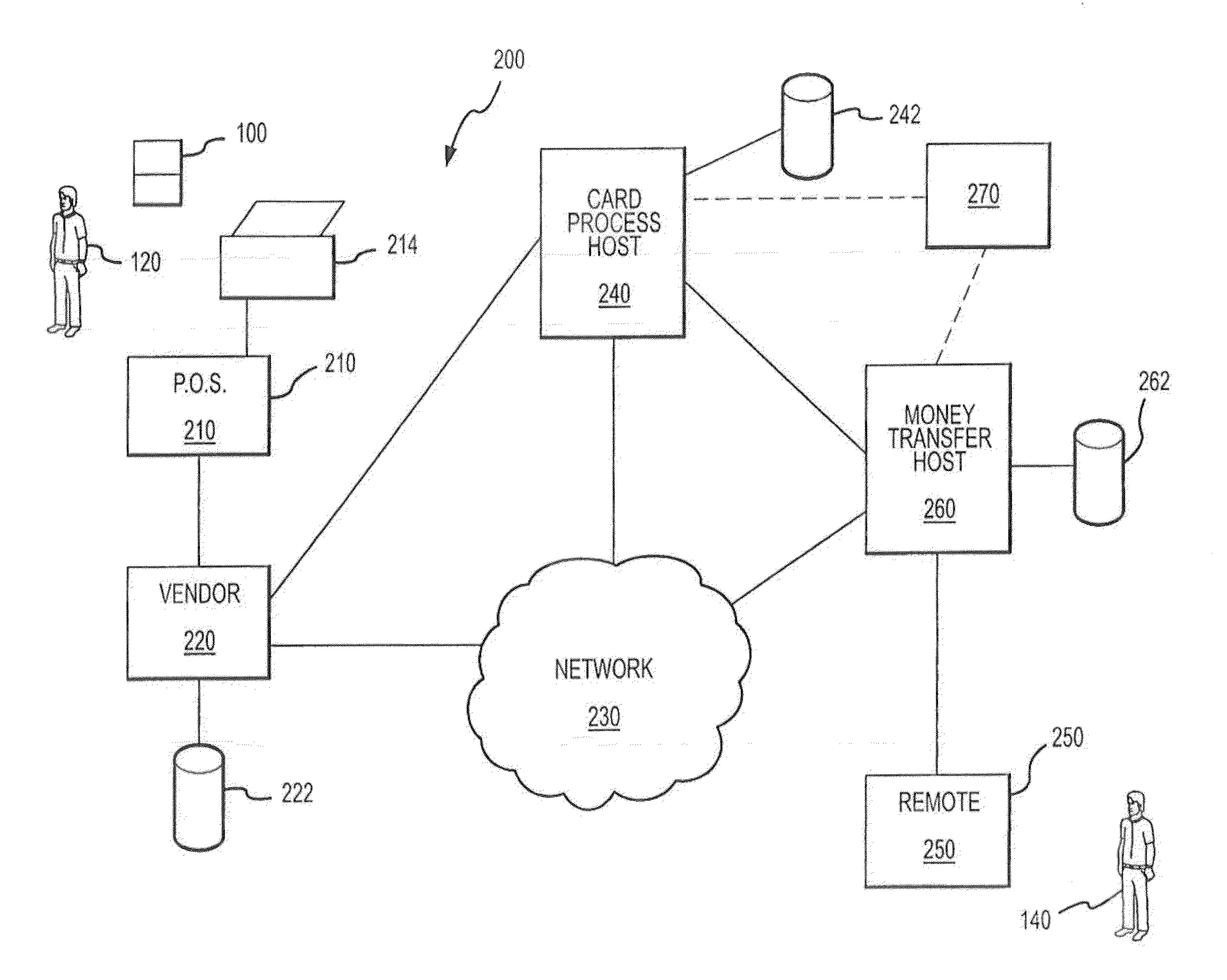

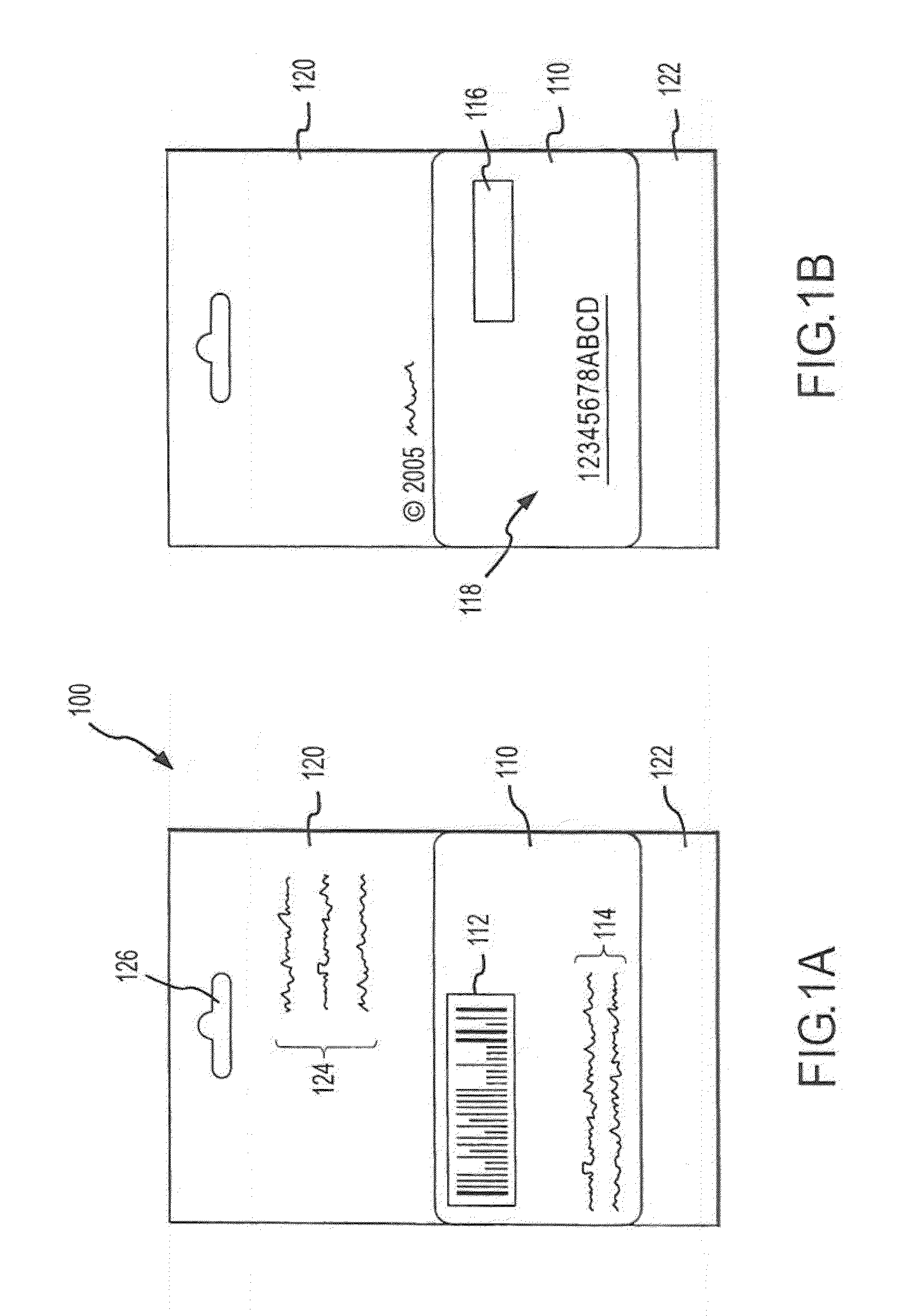

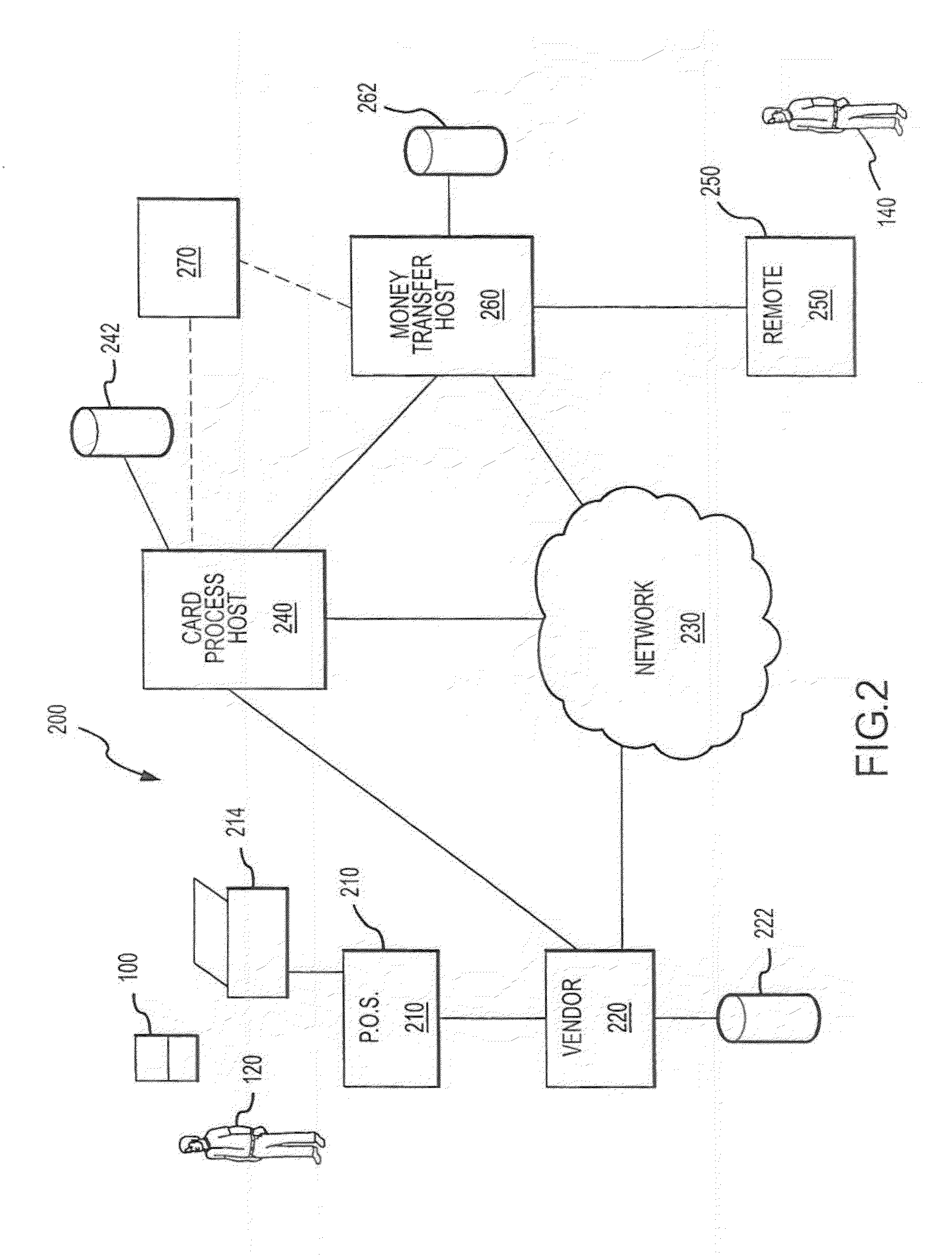

Method and system for transferring electronic funds

InactiveUS20100205095A1Promote commercial linkQuick applicationComplete banking machinesFinanceCredit cardThe Internet

A method and system for transferring electronic funds over the Internet wherein a sender provides payment information to a transfer processing system. The sender may choose from a plurality of different types of funds transfer, such as wire transfer, Western Union money transfer, various types of checks, and transfers to ATM debit / credit cards. The transfer processing system sends an electronic payment message to a recipient indicating the transfer of funds and a transfer message to a financial institution providing instructions to debit the sender's account and make those funds available to the recipient. If the recipient has an account with a financial institution that is affiliated with the transfer processing system of the present invention, the funds are credited to the recipient's account wherein the payment message serves as a confirmation message. If the recipient does not have such an account, the recipient may access the transfer processing system to access the funds made available by the system wherein the payment message serves as a payment availability message.

Owner:BLACKBIRD TECH

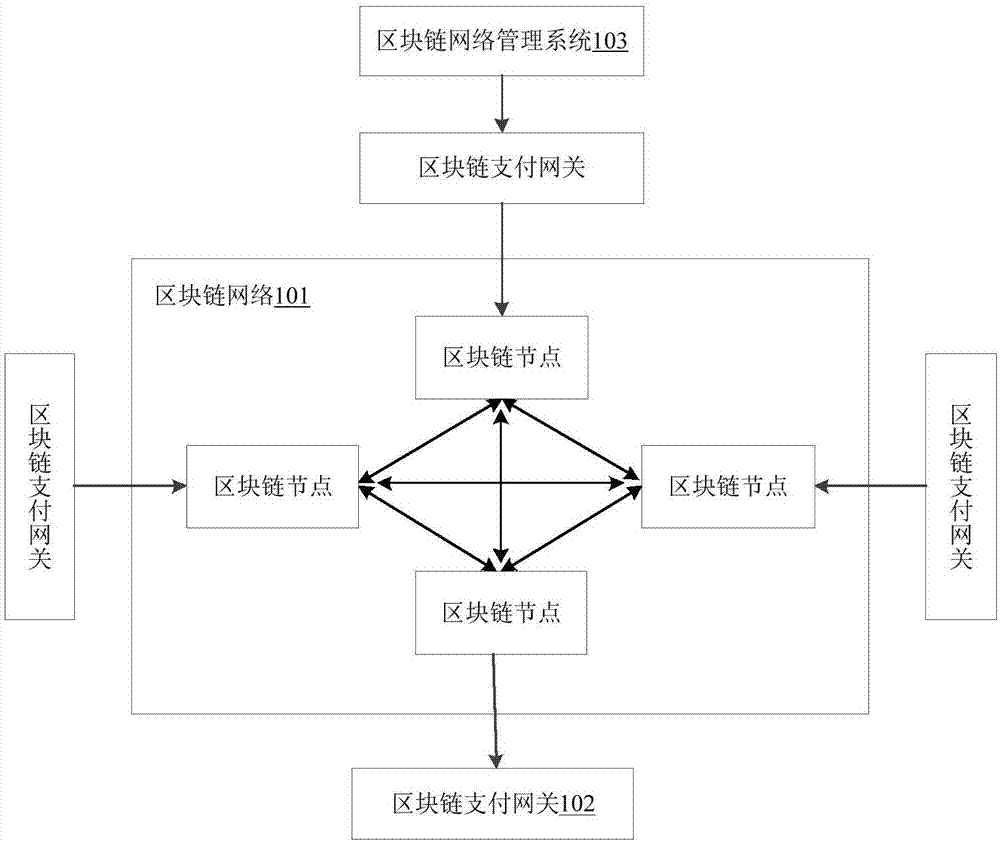

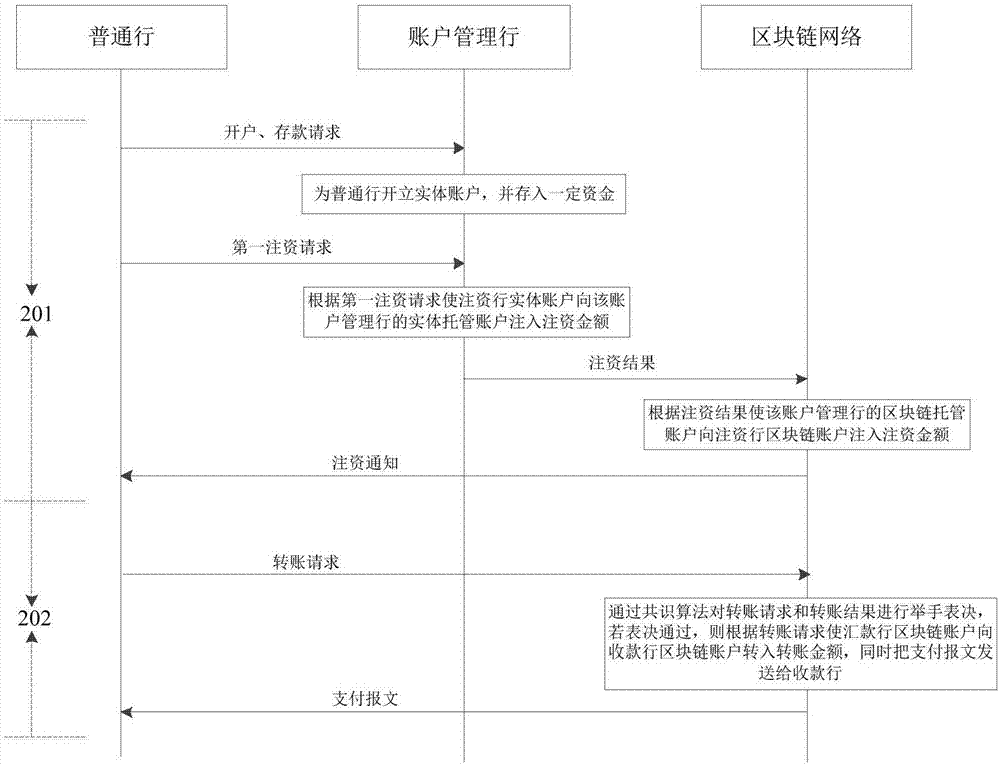

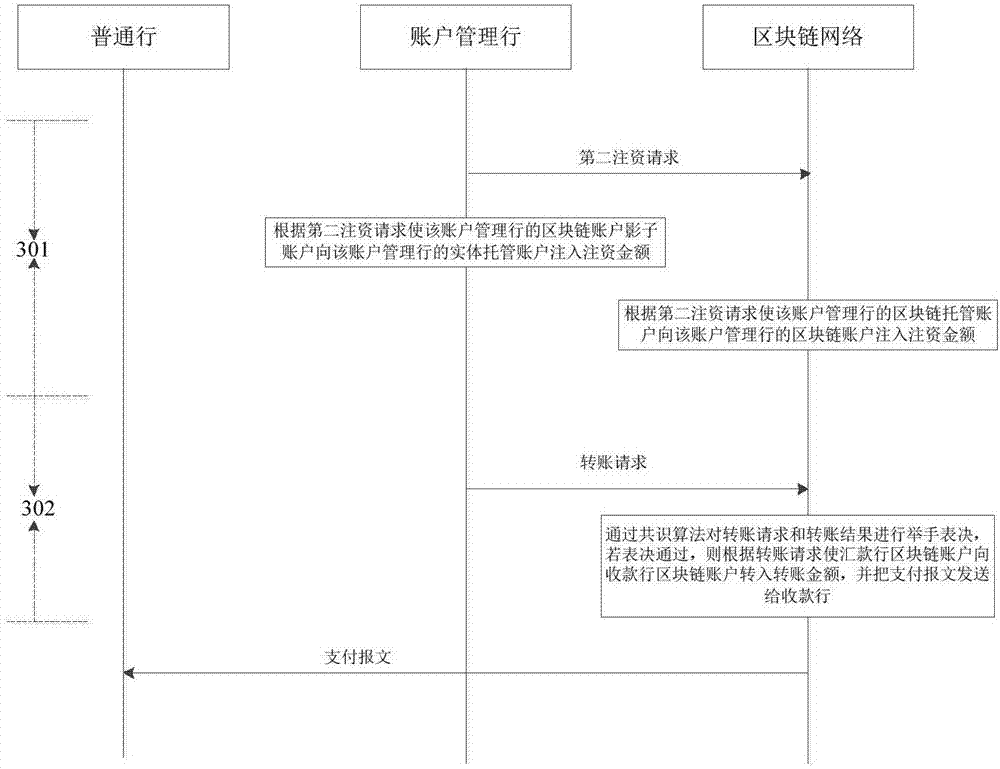

Cross-border payment system and cross-border payment method based on block chain payment system

ActiveCN107392584AReduce overheadReduce remittance costsPayment schemes/modelsInjection resultWire transfer

The present invention provides a cross-border payment system and a cross-border payment method based on a block chain payment system. The payment method comprises: an account management bank receives a first capital injection request sent by a common bank, the entity account of a capital injection bank inject capital injection sum to the entity escrow account of the account management bank according to the first capital injection request, a capital injection result is updated to a block chain network; the block chain network allows the block chain escrow account of the account management bank to inject the capital injection sum to the capital injection bank block chain account according to the capital injection result; and the block chain network receives a transferring request sent by the common bank through a block chain payment gateway, a consensus algorithm is employed to perform vote by raising hands of the transferring request and the transferring result, if the vote is passed, a remitting bank block chain account transfers the sum into a receiving bank block chain account according to the transferring request and sends the payment message to the receiving bank. According to the technical scheme, it is not necessary to employ an agent bank when cross-border payment is performed between banks, point-to-point payment can be directly realized, the block chain can complete the fund transferring between banks.

Owner:BANK OF CHINA

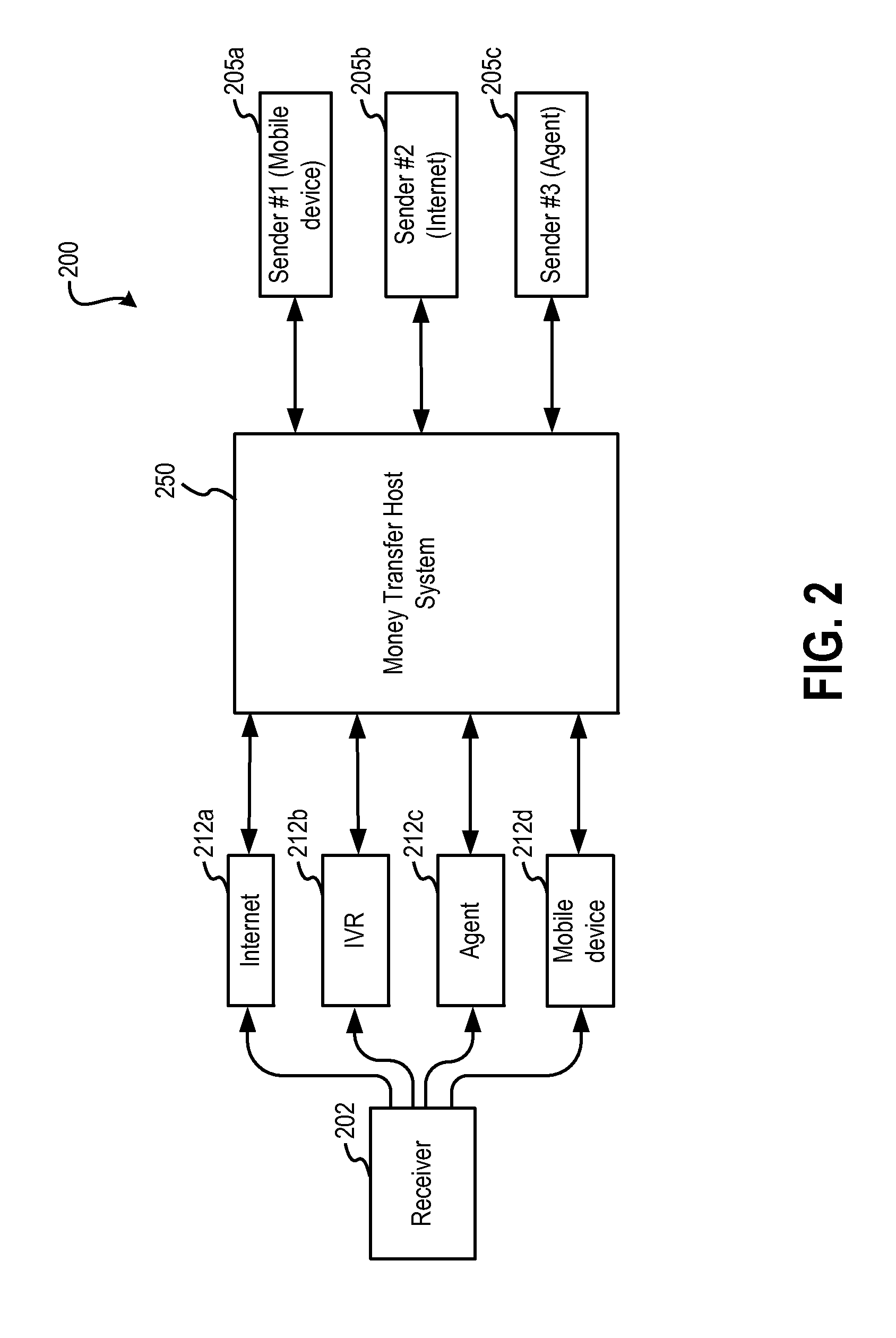

Receiver driven money transfer alert system

A method for performing a money transfer initiated by a receiver of the money transfer, wherein the method includes receiving a money transfer initiation request from the receiver and the money transfer initiation request includes an amount of funds to be transferred, receiver information, and sender information. The method also includes staging a money transfer transaction after receiving the money transfer initiation request, wherein the money transfer transaction is pending an authorization by the sender to fund the money transfer. The method further includes providing the sender with a notification of the money transfer transaction, receiving the authorization to fund the money transfer transaction, and executing the money transfer to transfer the funds from the sender to the receiver.

Owner:THE WESTERN UNION CO

Methods, devices and bank computers for consumers using communicators to wire funds to sellers and vending machines

Owner:XYLON LLC

Network distributed tracking wire transfer protocol

InactiveUS7103640B1Efficient changeEfficient managementDigital data information retrievalMultiple digital computer combinationsTransmission protocolWire transfer

A network distributed tracking wire transfer protocol for storing and retrieving data across a distributed data collection. The protocol includes a location string for specifying the network location of data associated with an entity in the distributed data collection, and an identification string for specifying the identity of an entity in the distributed data collection. According to the protocol, the length of the location string and the length of the identification string are variable, and an association between an identification string and a location string can be spontaneously and dynamically changed. The network distributed tracking wire transfer protocol is application independent, organizationally independent, and geographically independent. A method for using the protocol in a distributed data collection environment and a system for implementing the protocol are also provided.

Owner:KOVE IO INC

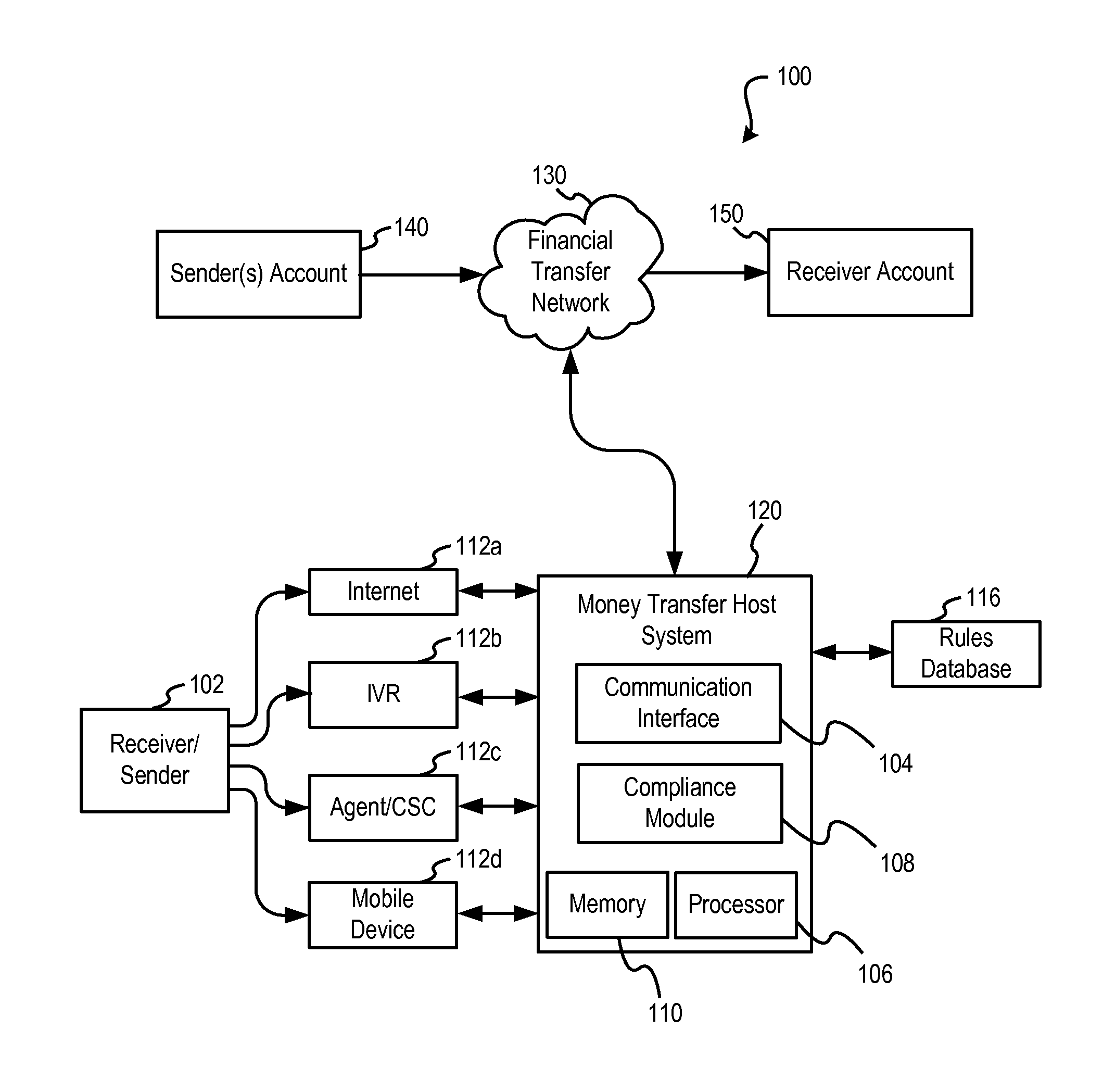

Money transfer systems and methods

The present invention provides systems and methods of facilitating money transfers. The method includes receiving, at a money transfer system, access to a customer's account, establishing, at the money transfer system, a money transfer record including a recipient and an amount, and receiving, at the money transfer system, an identifier for the money transfer record. The method further includes receiving presentation of the identifier at an input device of the money transfer system and authorizing a money transfer associated with the money transfer record.

Owner:THE WESTERN UNION CO

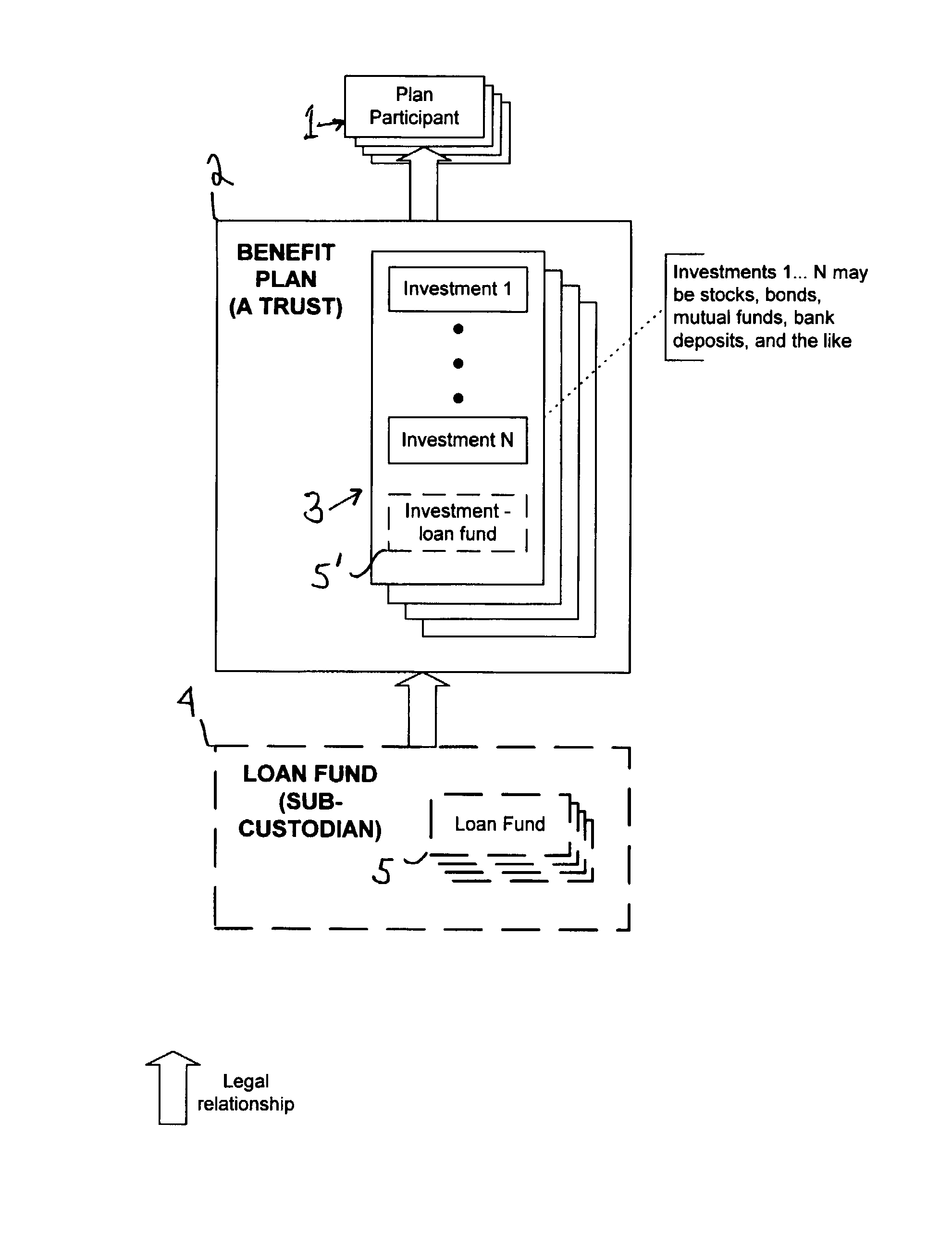

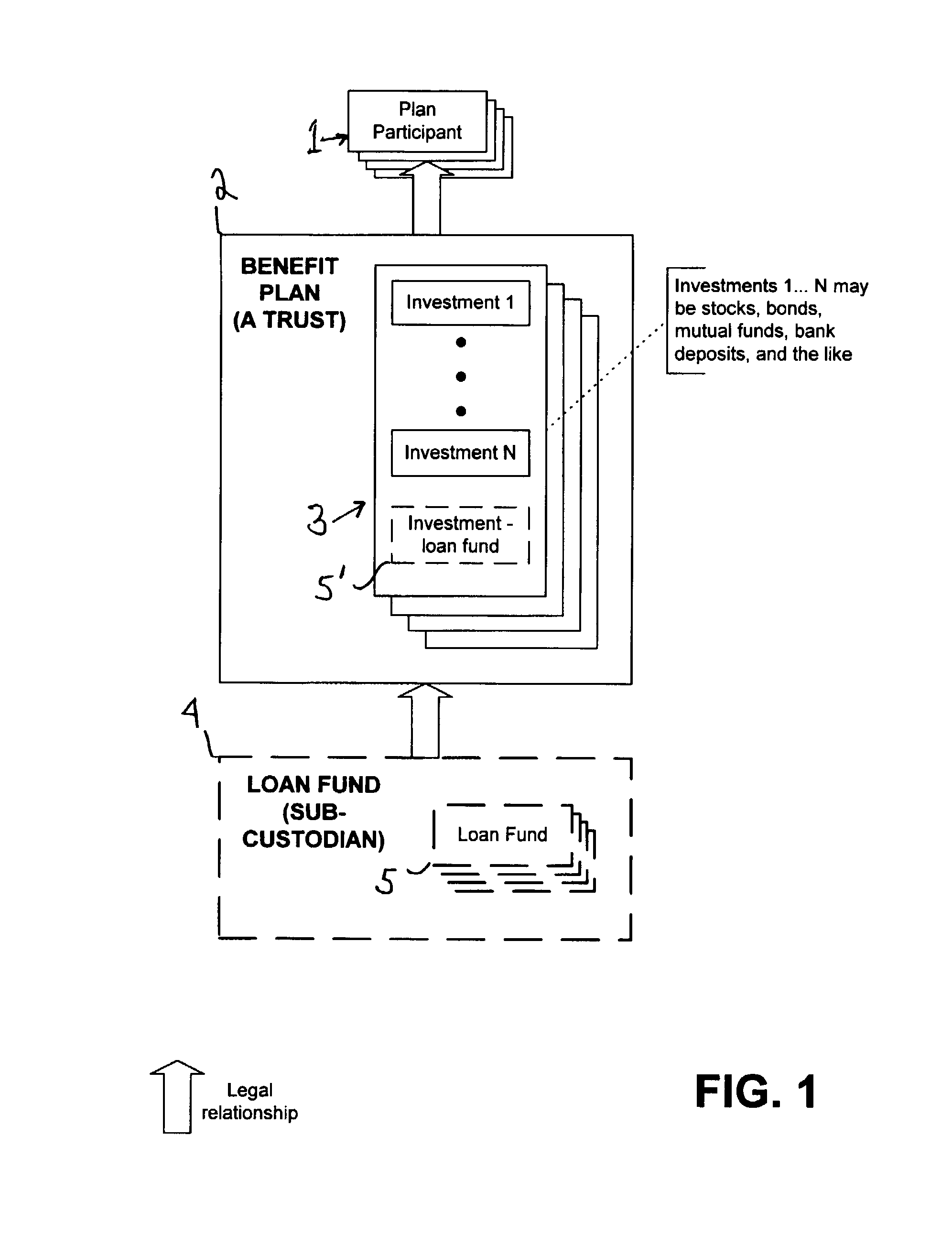

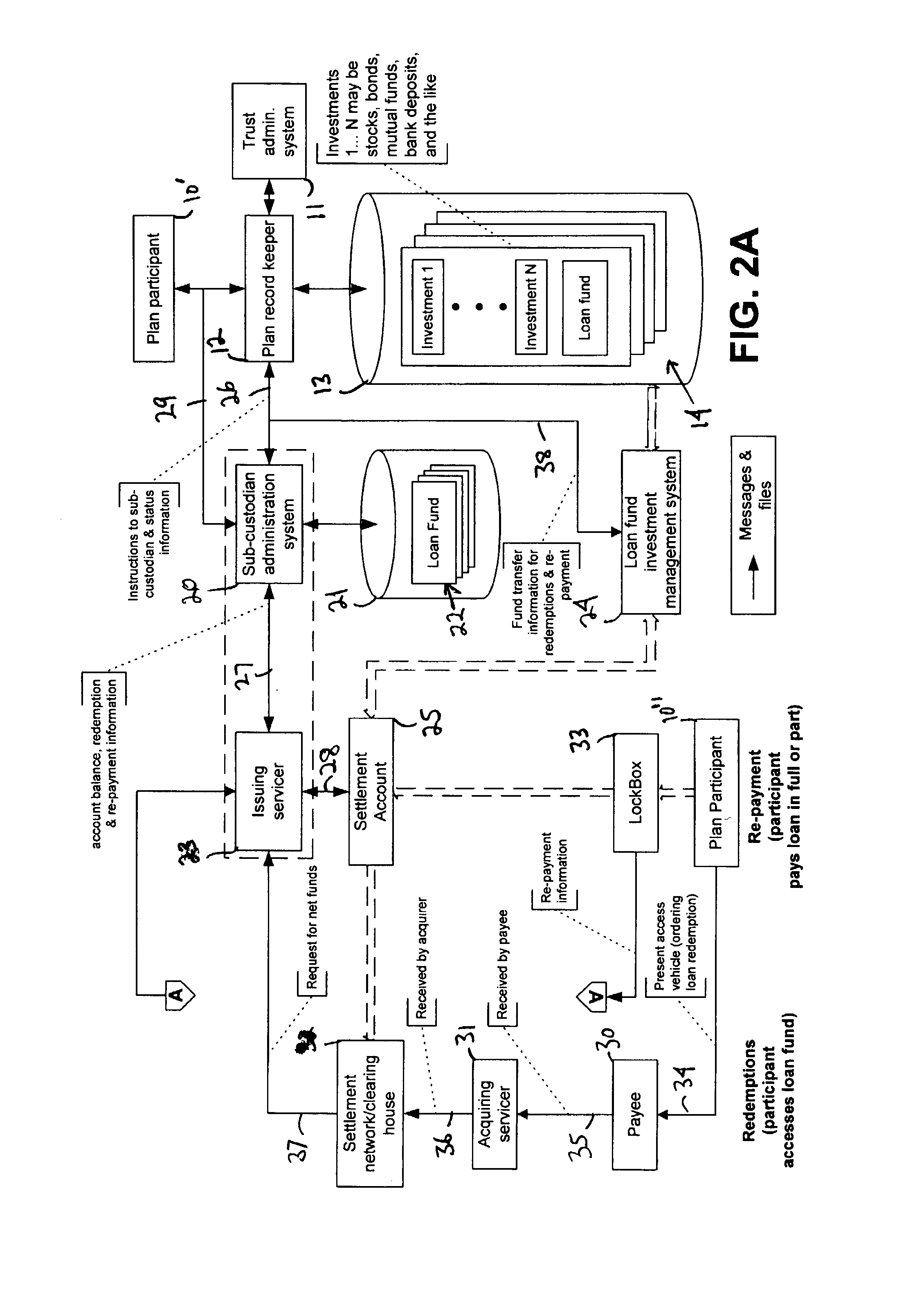

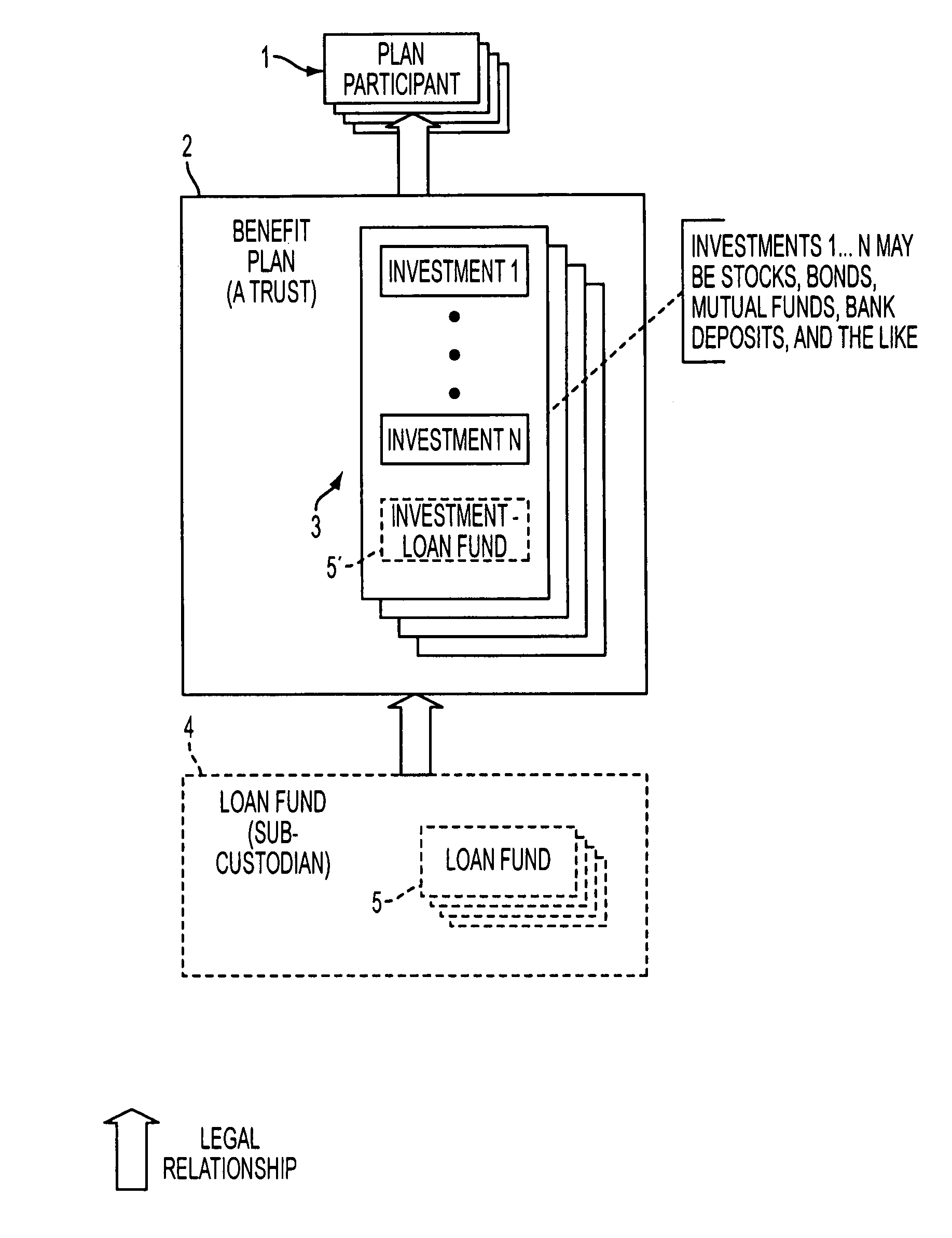

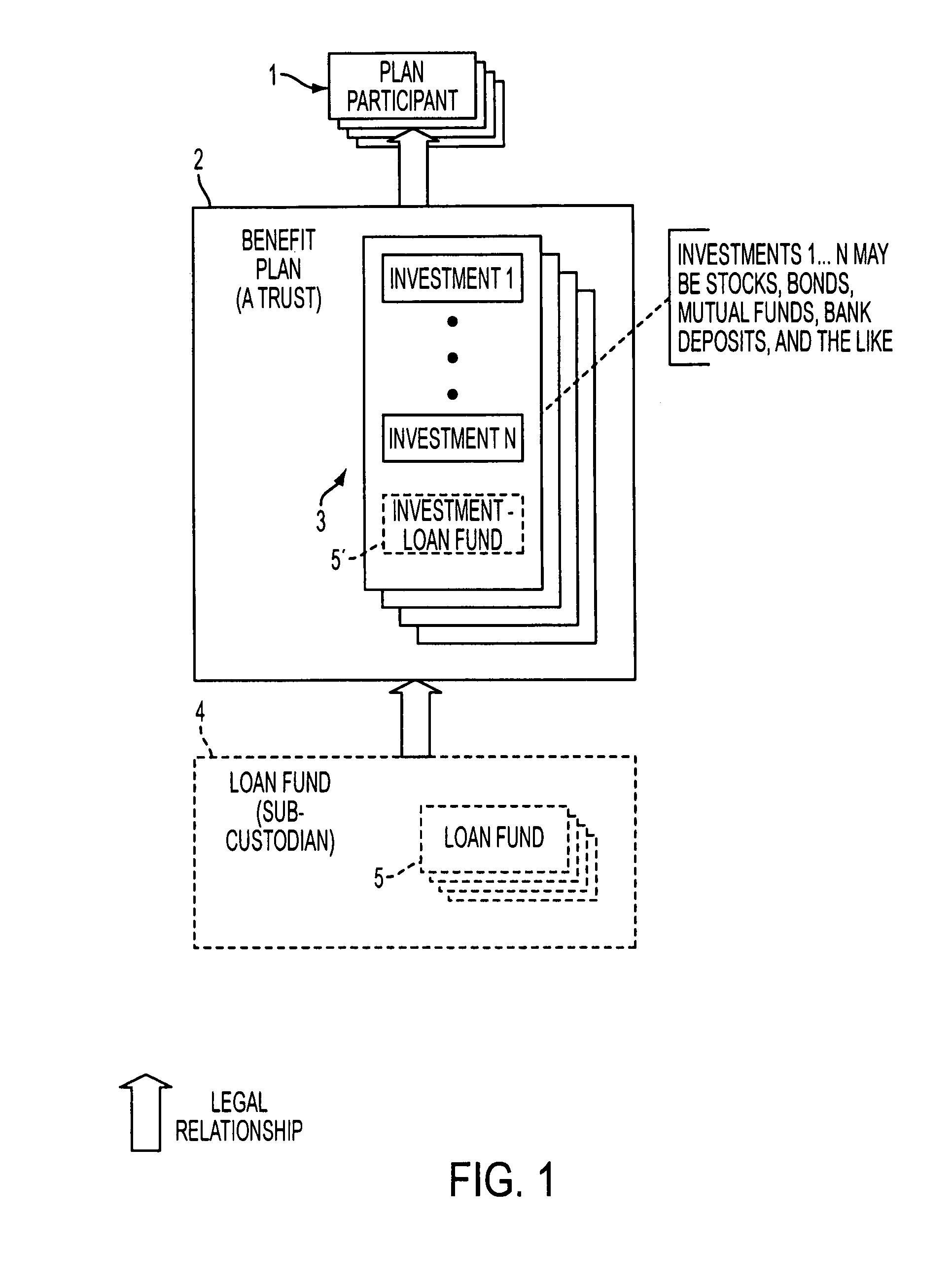

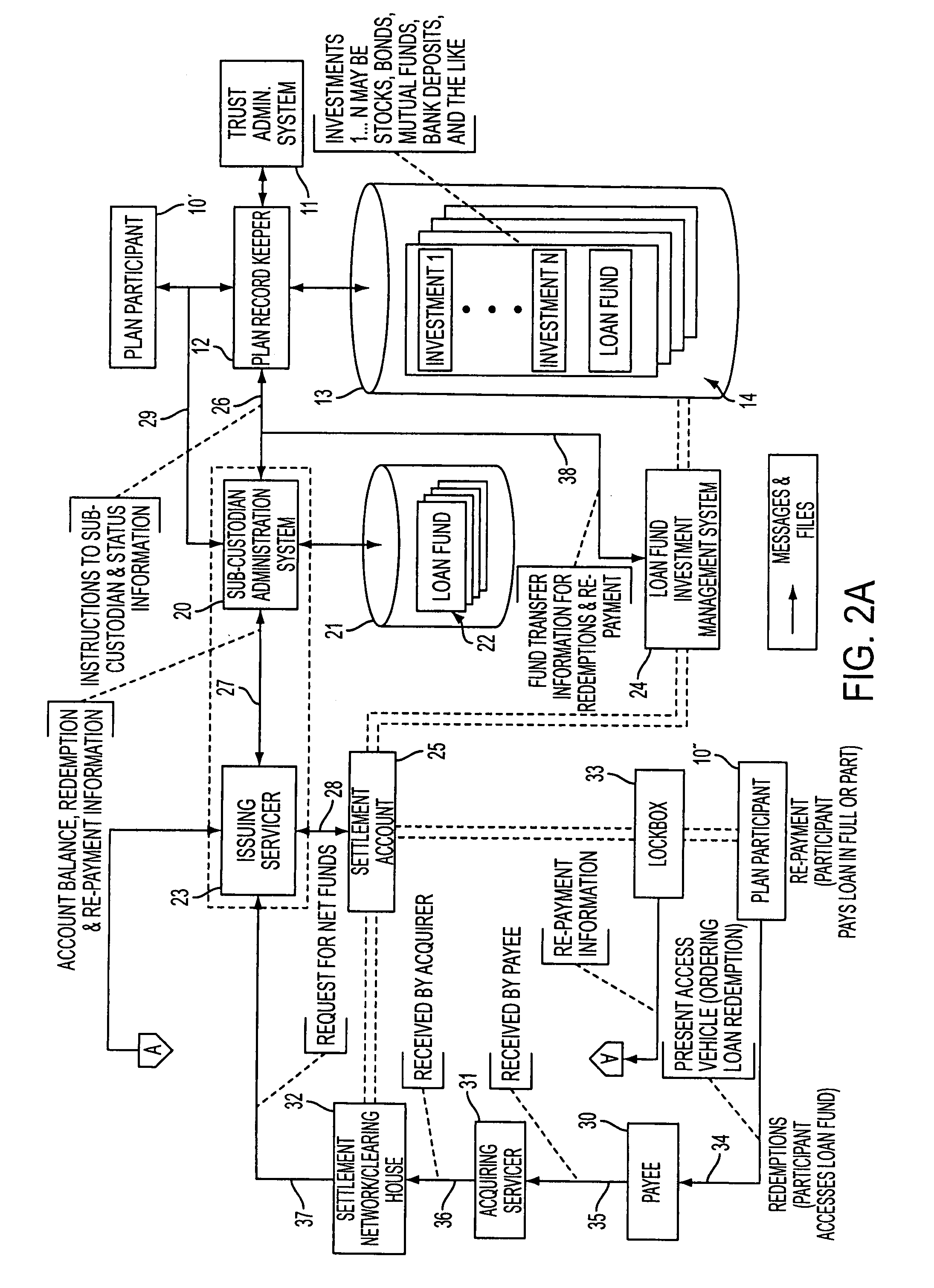

Systems and methods for providing loan management from cash or deferred income arrangements

This invention includes methods and systems for providing participants in benefit plans with loans related to the participants' vested assets in the benefit plans. Administrative systems of this invention provide for loan-fund account setup and modification, manage account use, interface to established access vehicles (check, credit card, debit card, wire transfer, ACH, sweeps, ATMs, etc.), as well as to established benefit-plan management systems. Methods of this invention manage participant loans in accordance with statutes, regulations, and policies applicable in relevant jurisdictions. Overall, this invention provides participants low cost financing using tax-advantaged assets which is particularly useful to individuals without other access to alternative low cost credit.

Owner:ACCESS CONTROL ADVANTAGE

Systems and methods for providing loan management from cash or deferred income arrangements

This invention includes methods and systems for providing participants in benefit plans with loans related to the participants' vested assets in the benefit plans. Administrative systems of this invention provide for loan-fund account setup and modification, manage account use, interface to established access vehicles (check, credit card, debit card, wire transfer, ACH, sweeps, ATMs, etc.), as well as to established benefit-plan management systems. Methods of this invention manage participant loans in accordance with statutes, regulations, and policies applicable in relevant jurisdictions. Overall, this invention provides participants low cost financing using tax-advantaged assets which is particularly useful to individuals without other access to alternative low cost credit.

Owner:ACCESS CONTROL ADVANTAGE

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com