Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

137 results about "Bank teller" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A bank teller (often abbreviated to simply teller) is an employee of a bank who deals directly with customers. In some places, this employee is known as a cashier or customer representative. Most teller jobs require experience with handling cash and a high school diploma. Most banks provide on-the-job training.

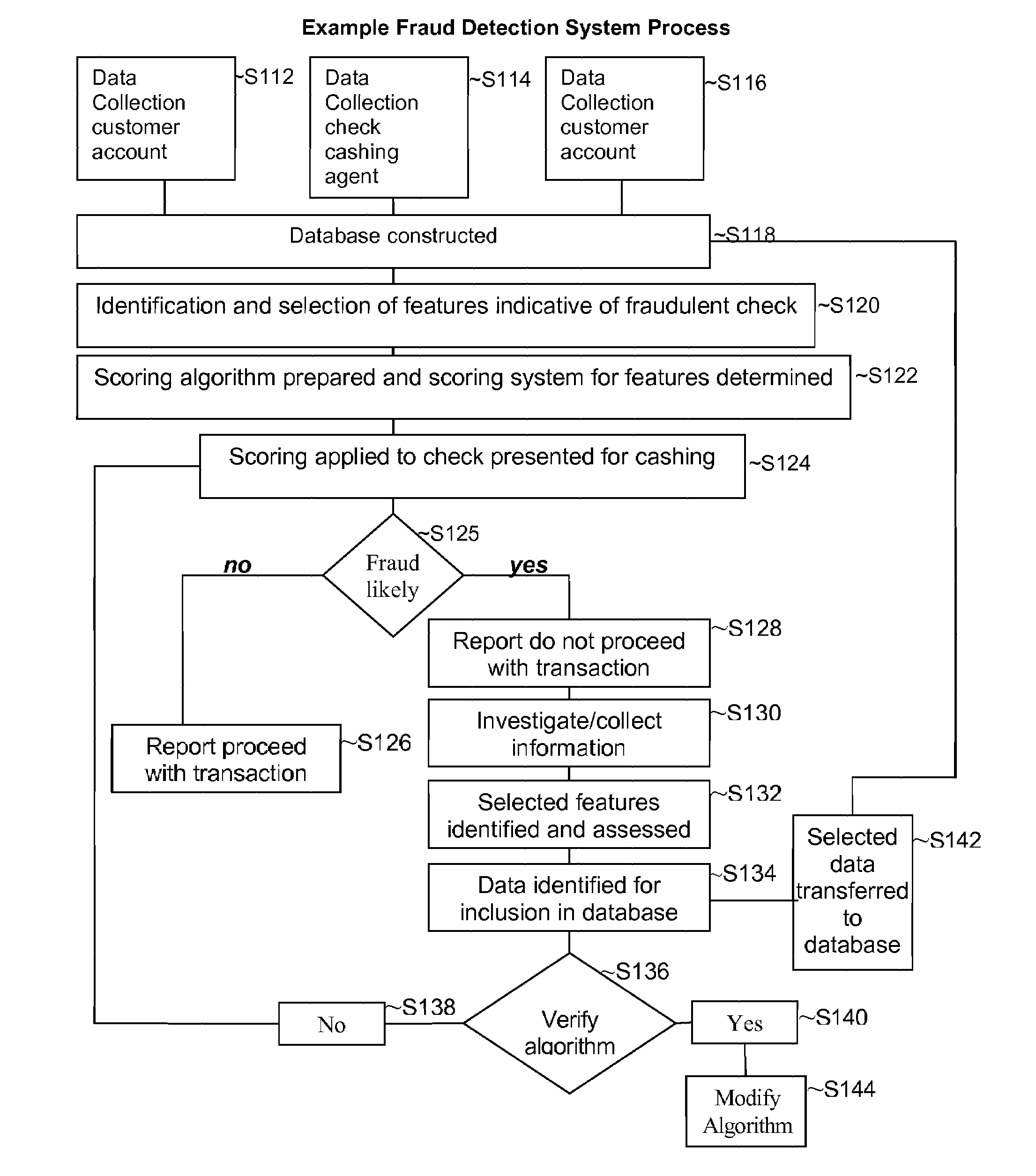

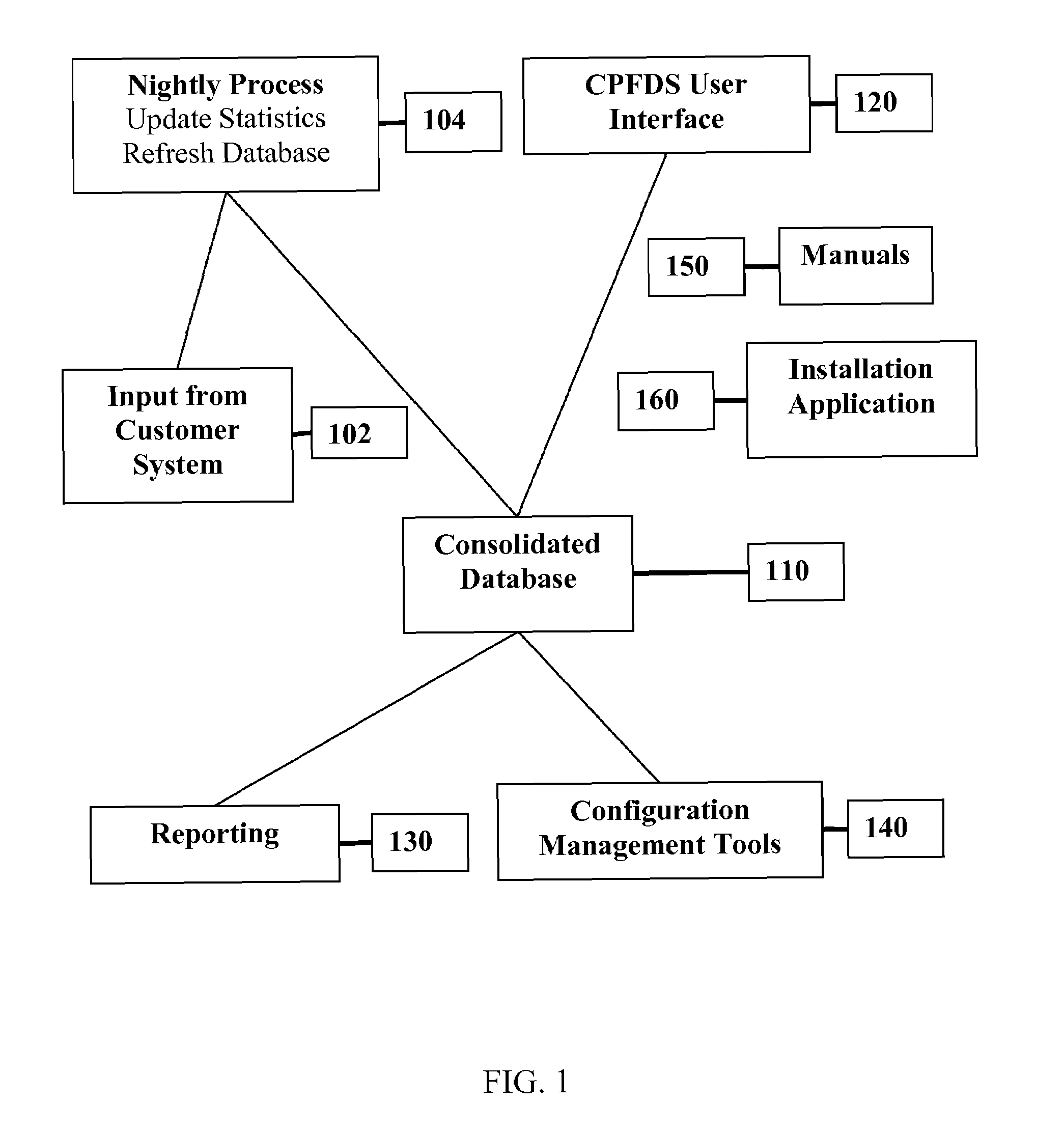

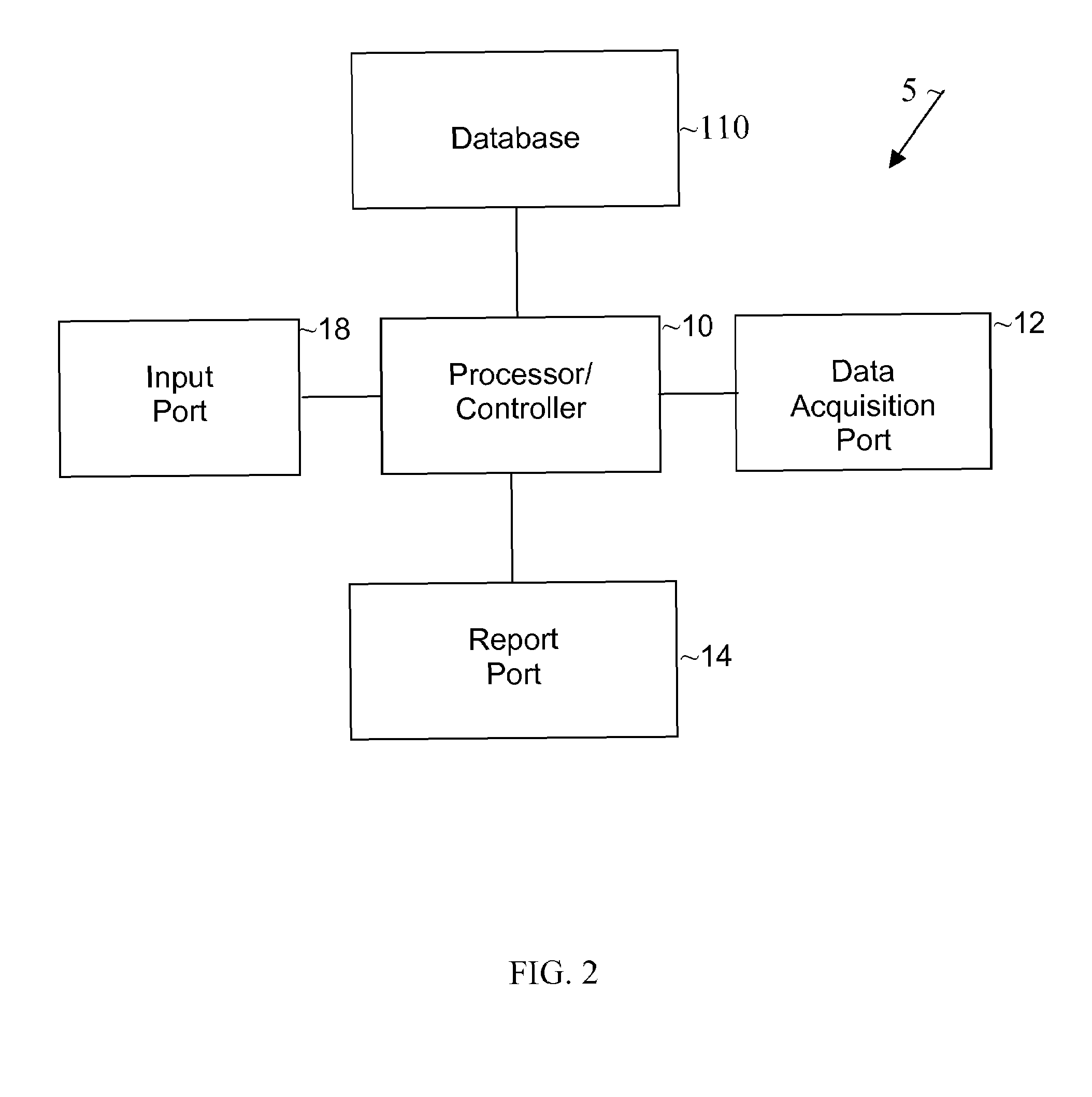

System and method for screening for fraud in commercial transactions

InactiveUS20070244782A1Prevent improper transactionFinancePaper-money testing devicesSystems analysisBank teller

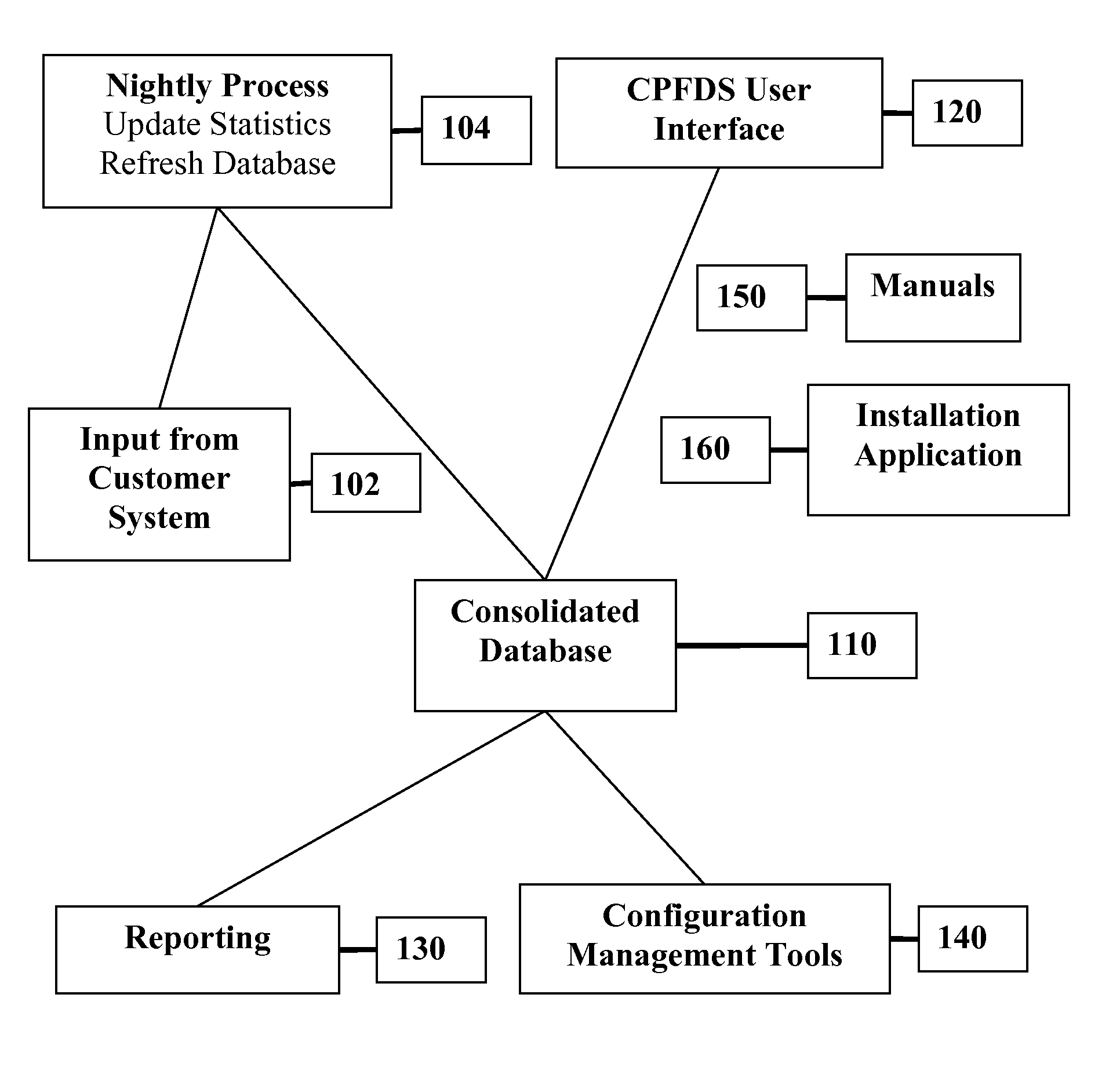

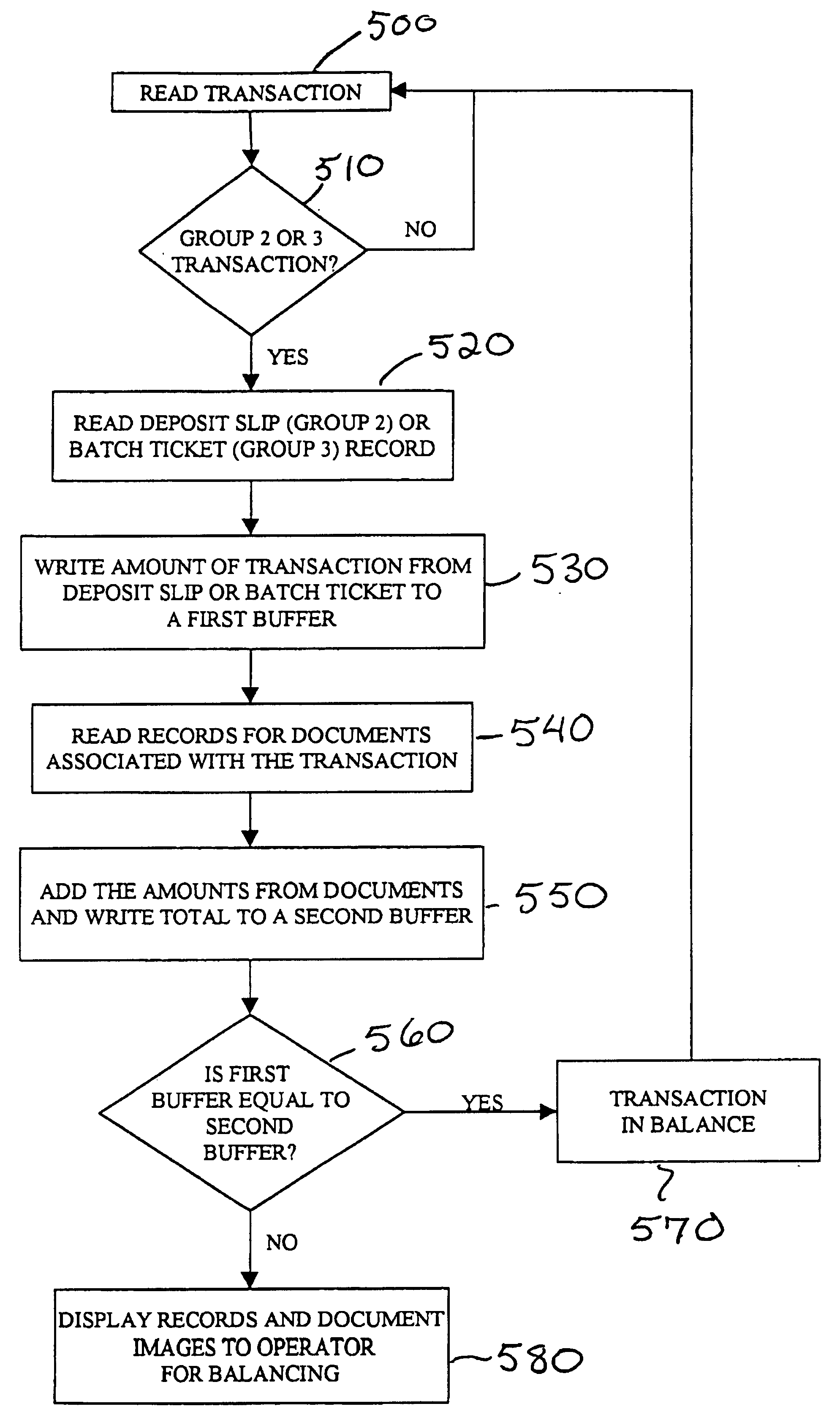

A method for screening for potential fraud in commercial paper is provided. For example, a method of the invention comprises steps of presenting a check for cashing to a check cashing agent (e.g., a bank teller); scanning or inspecting the check for data; selecting data for analysis; analyzing selected data with a commercial paper fraud detection system (“CPFDS”); and reporting results of the fraud detection system analysis to the check cashing agent. The commercial paper fraud detection system provides a means for predicting if commercial paper is potentially fraudulent. For example, the commercial paper fraud detection system may detect stolen checks, altered checks, and fabricated or counterfeit checks, among other types of fraud. Also provided is a computer program product for detecting fraud in commercial paper.

Owner:CHIMENTO MARC A

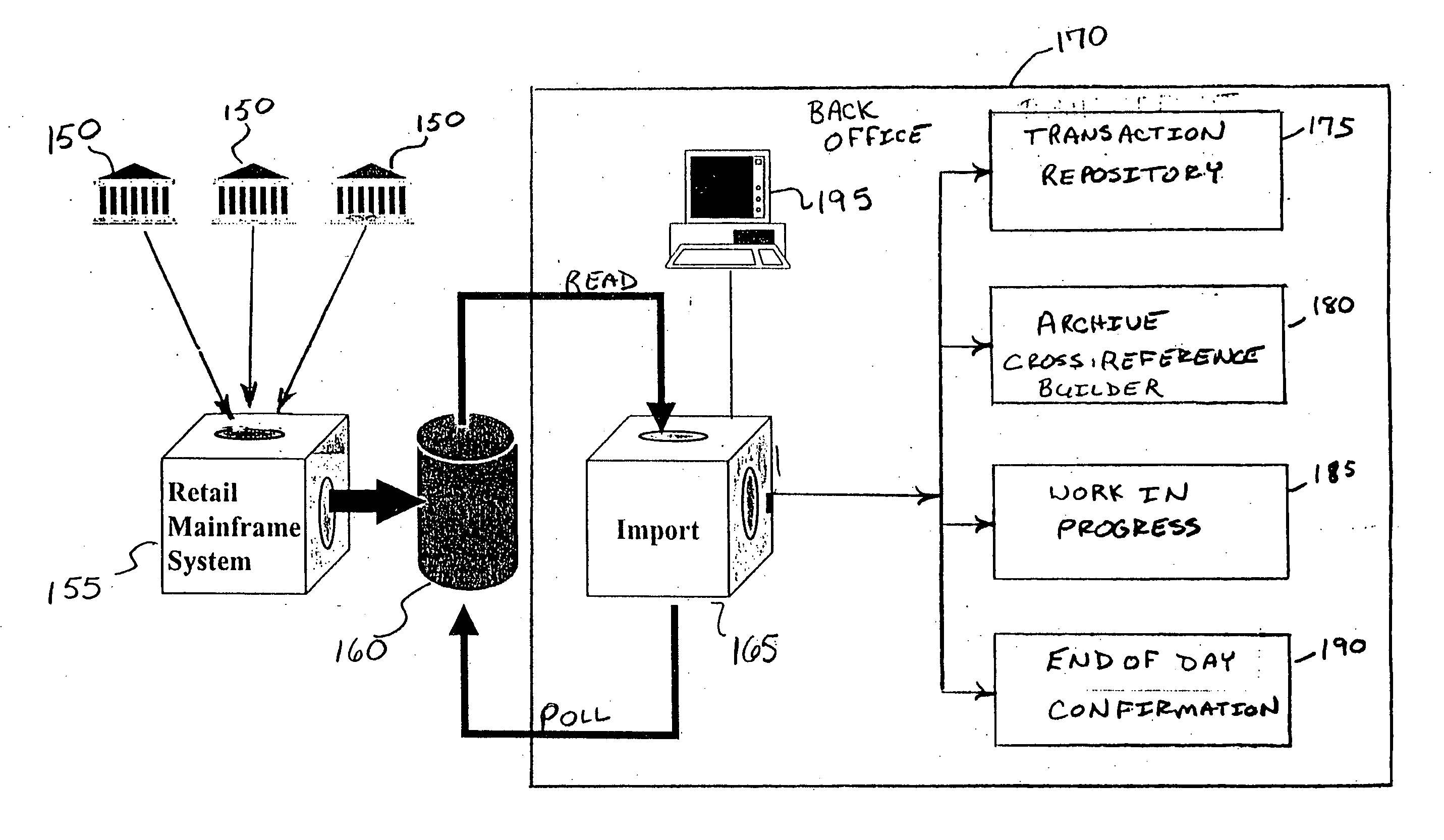

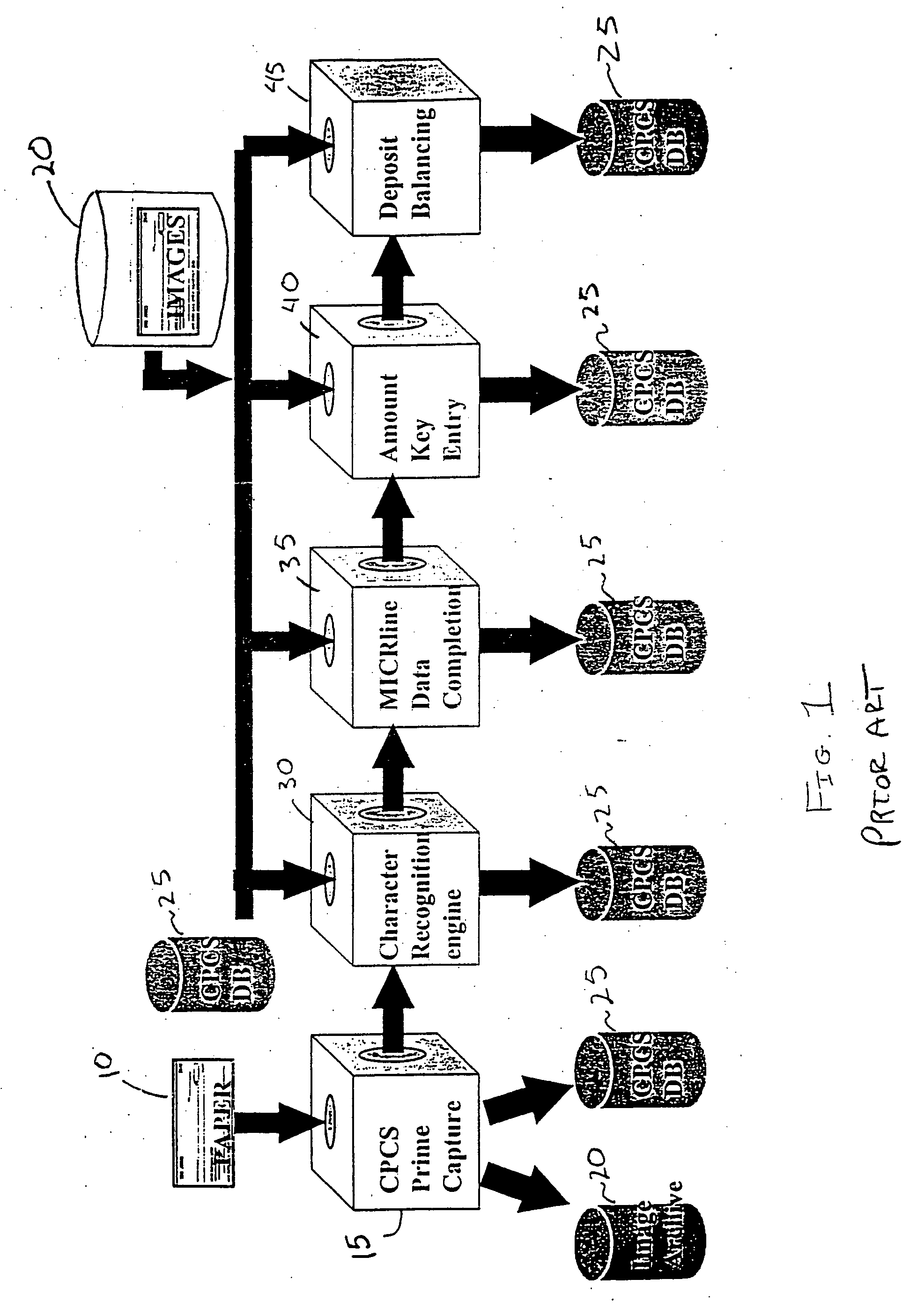

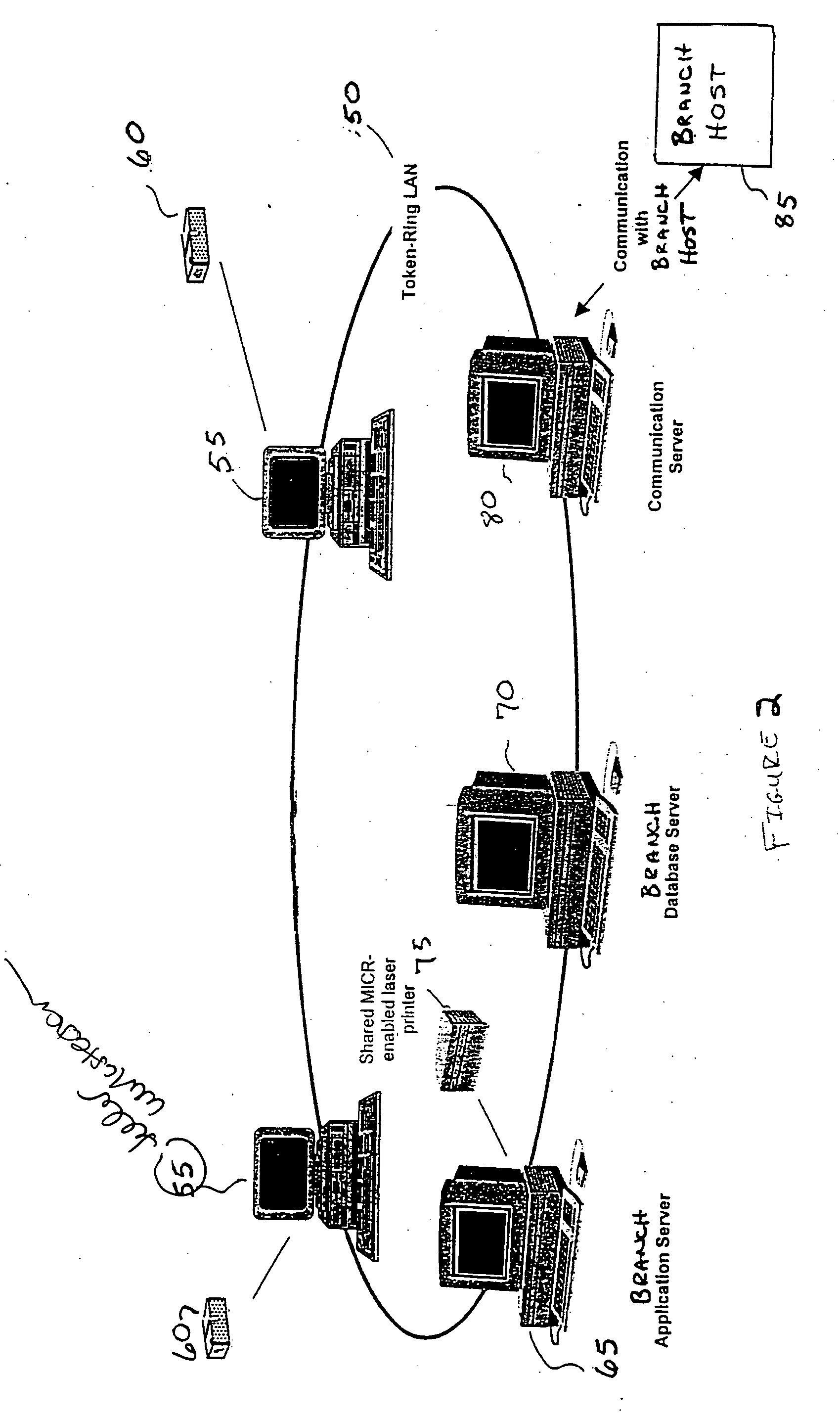

System and method for back office processing of banking transactions using electronic files

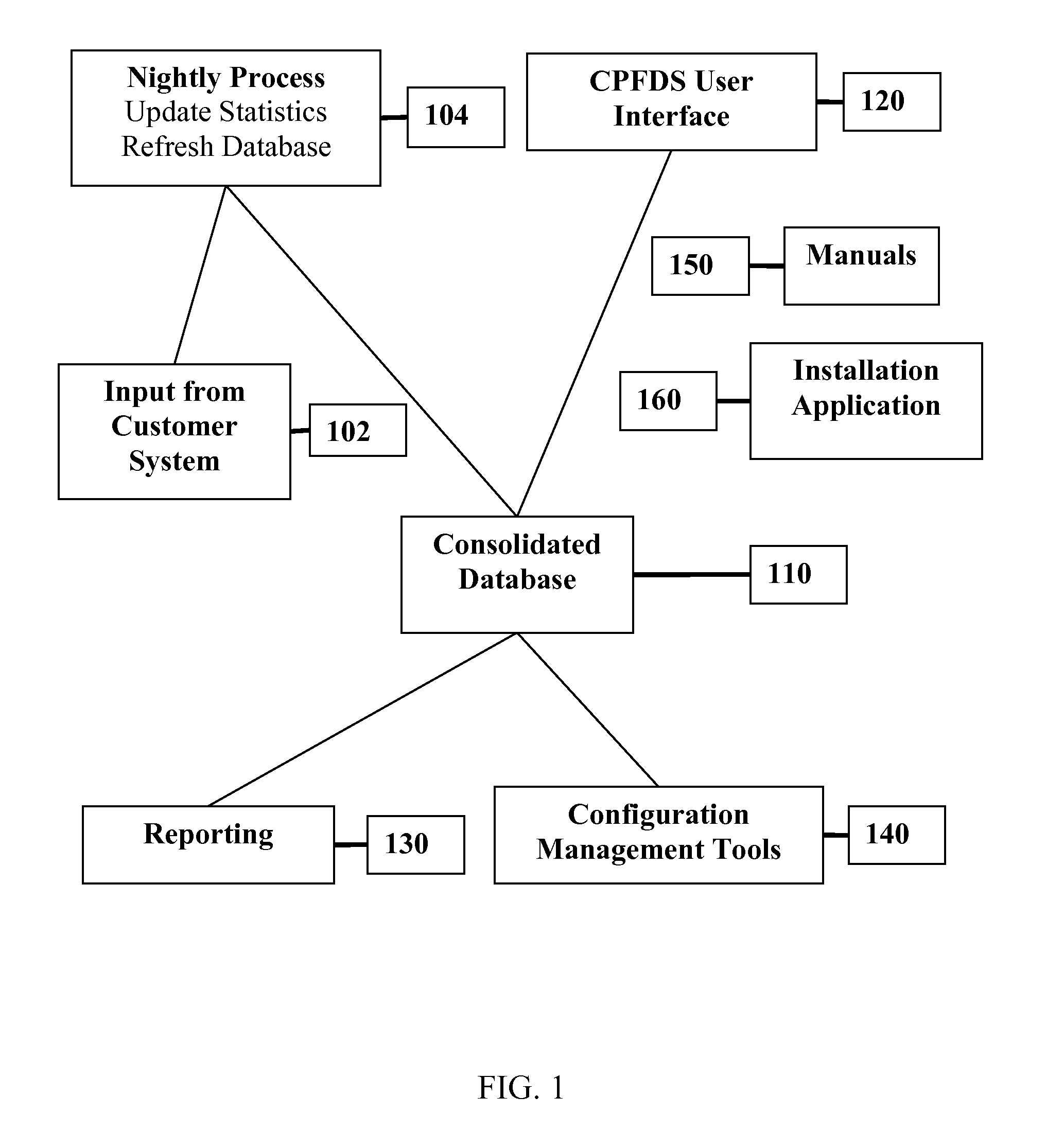

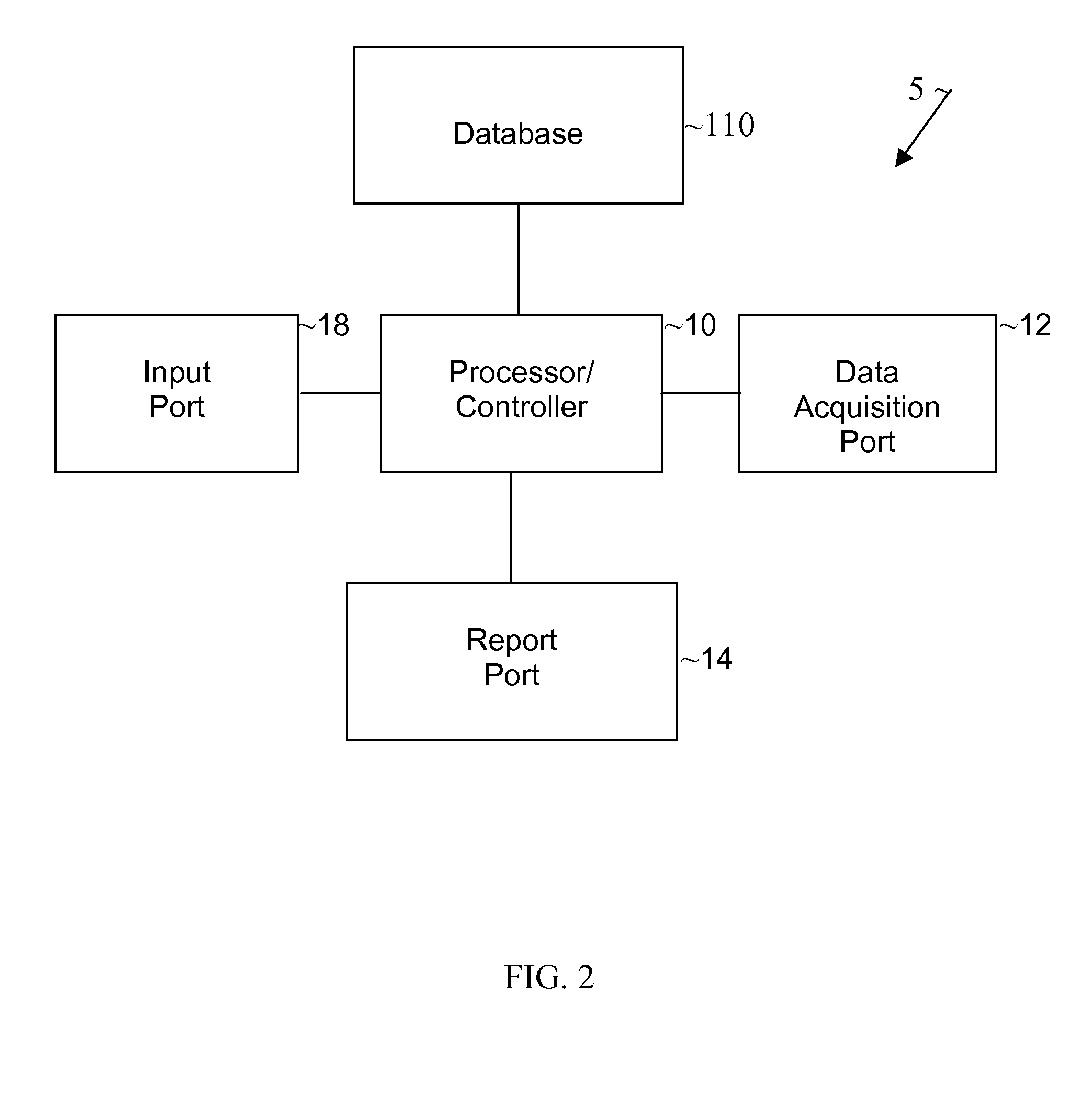

InactiveUS7062456B1Reduce equipmentReduce laborFinanceAutomatic teller machinesBank tellerRelevant information

As banking transactions are processed by a bank teller, all of the relevant information with respect to the transaction (e.g., dollar amount) is captured in an electronic file. Each of the electronic files from the various branches of the bank are forwarded to a central back office processing center where the electronic files are combined into a single Transaction Repository. At the end of the branch day, all of the paper associated with the transactions is forwarded from the branches to the back office processing center. The paper transactions are imaged in the conventional manner and the Magnetic Ink Character Recognition (MICR) data is read from the paper. The present invention then automatically correlates the images and MICR data captured from the paper with the complete transaction record contained in the Transaction Repository. Most of the conventional back office processing can now be performed without the need to perform character recognition and without the need for excess human intervention.

Owner:JPMORGAN CHASE BANK NA

Automated document cashing system

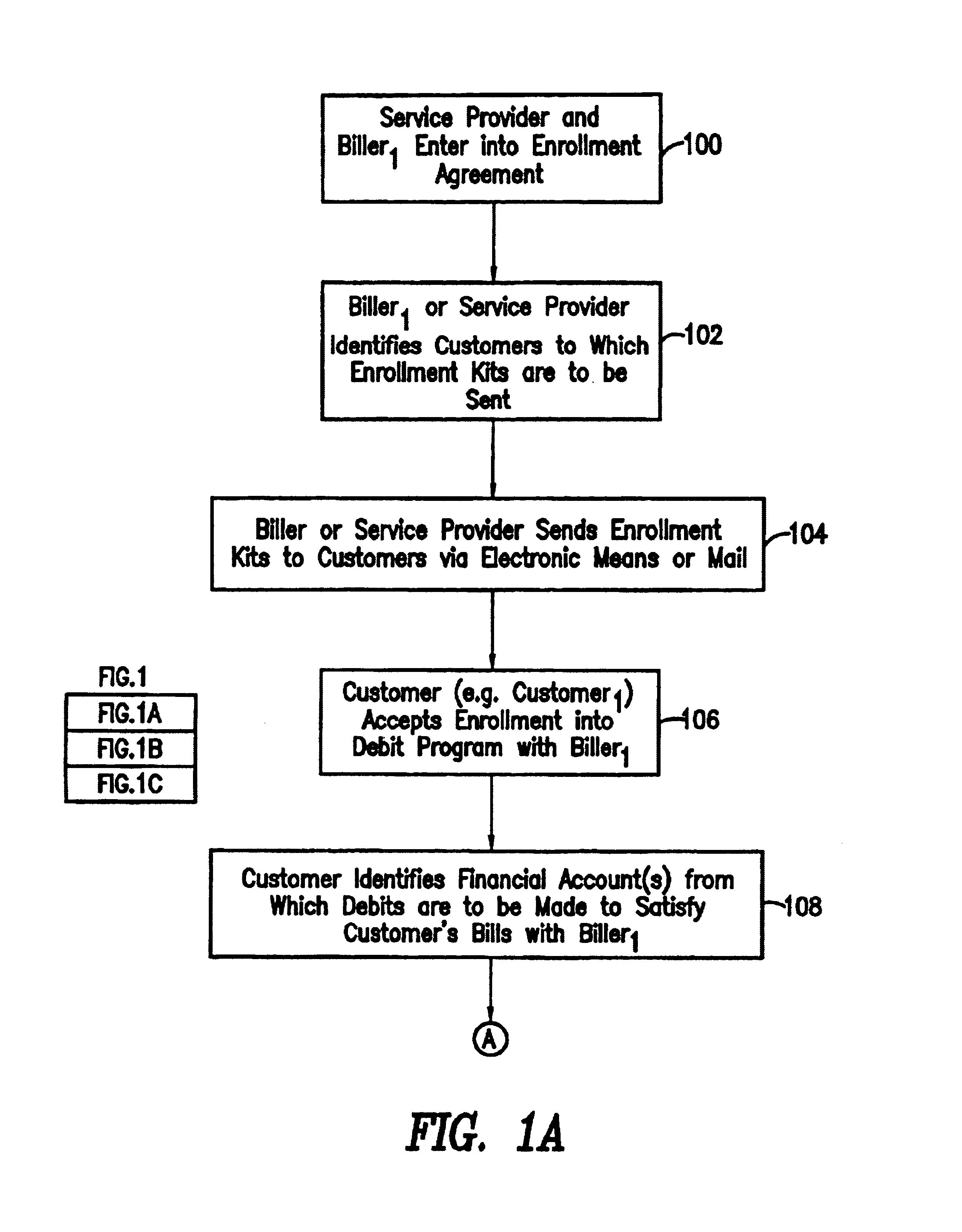

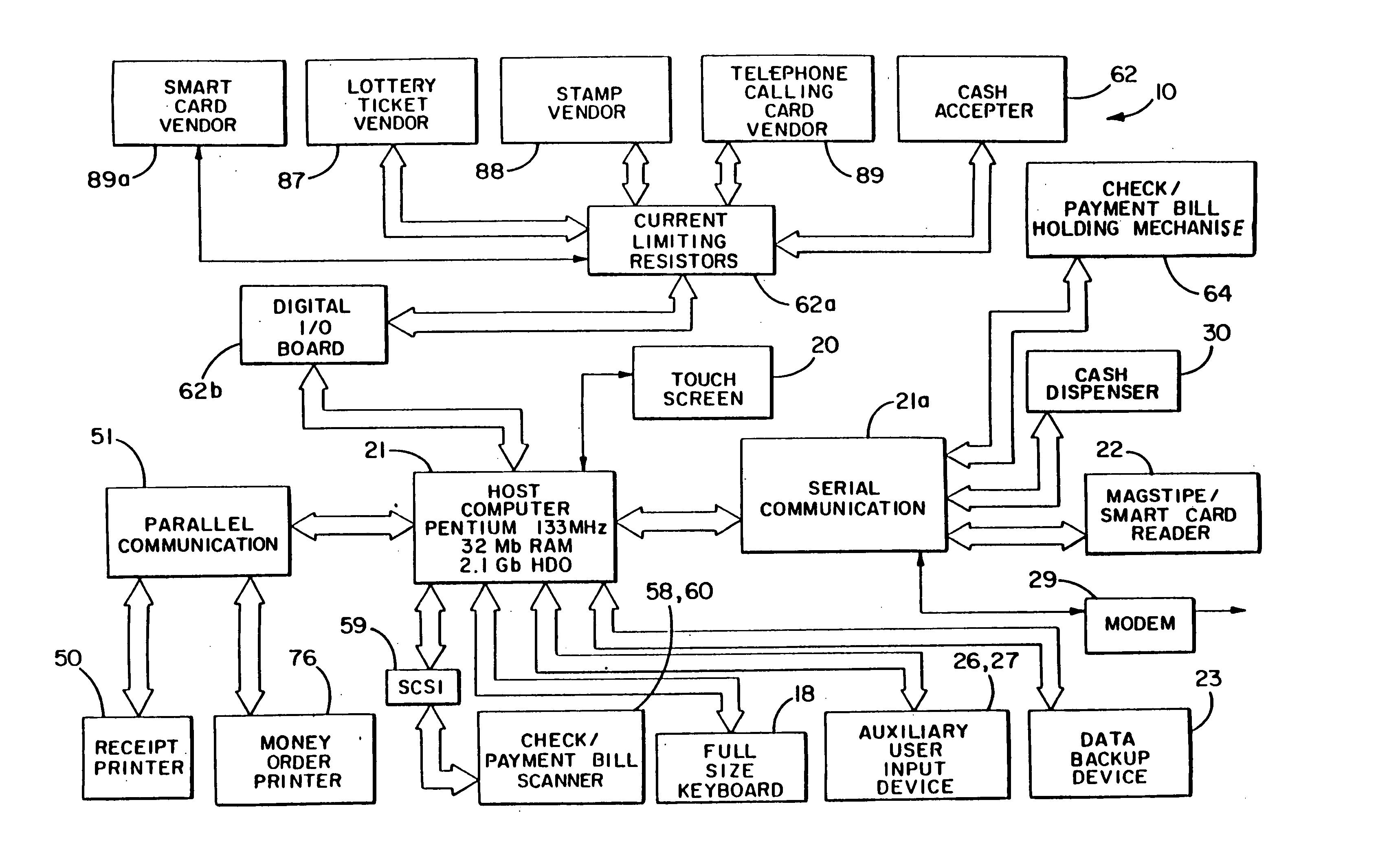

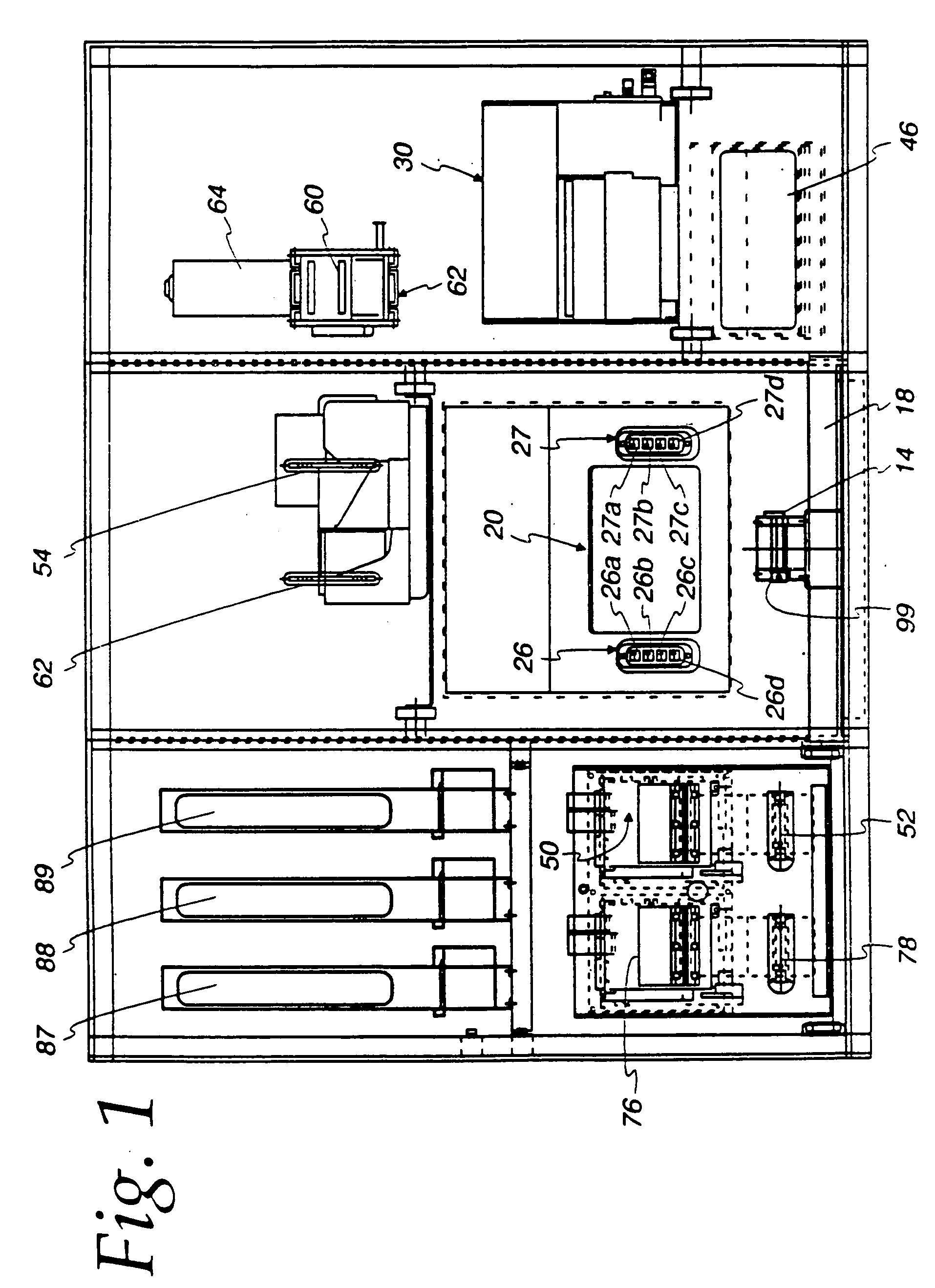

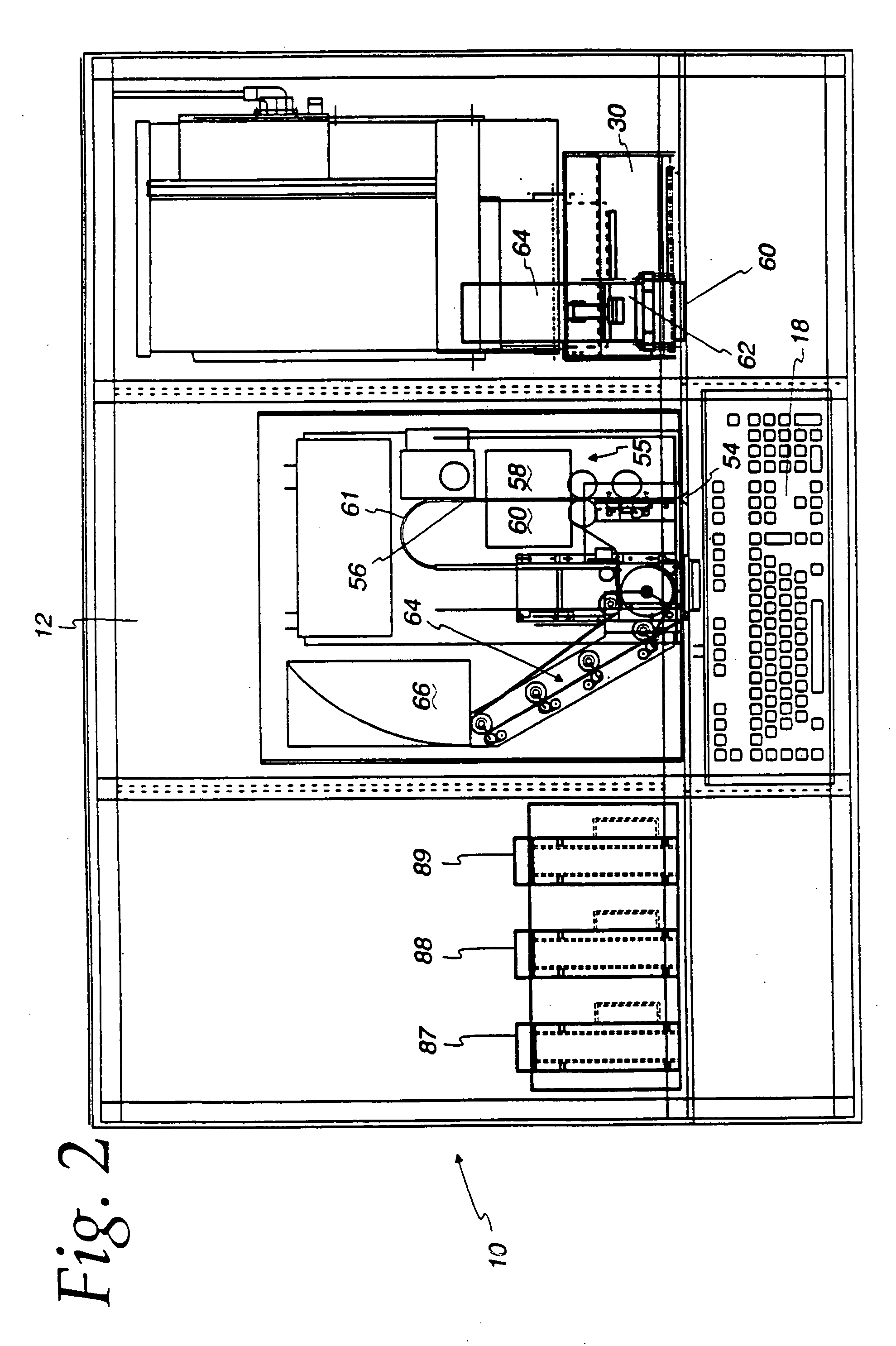

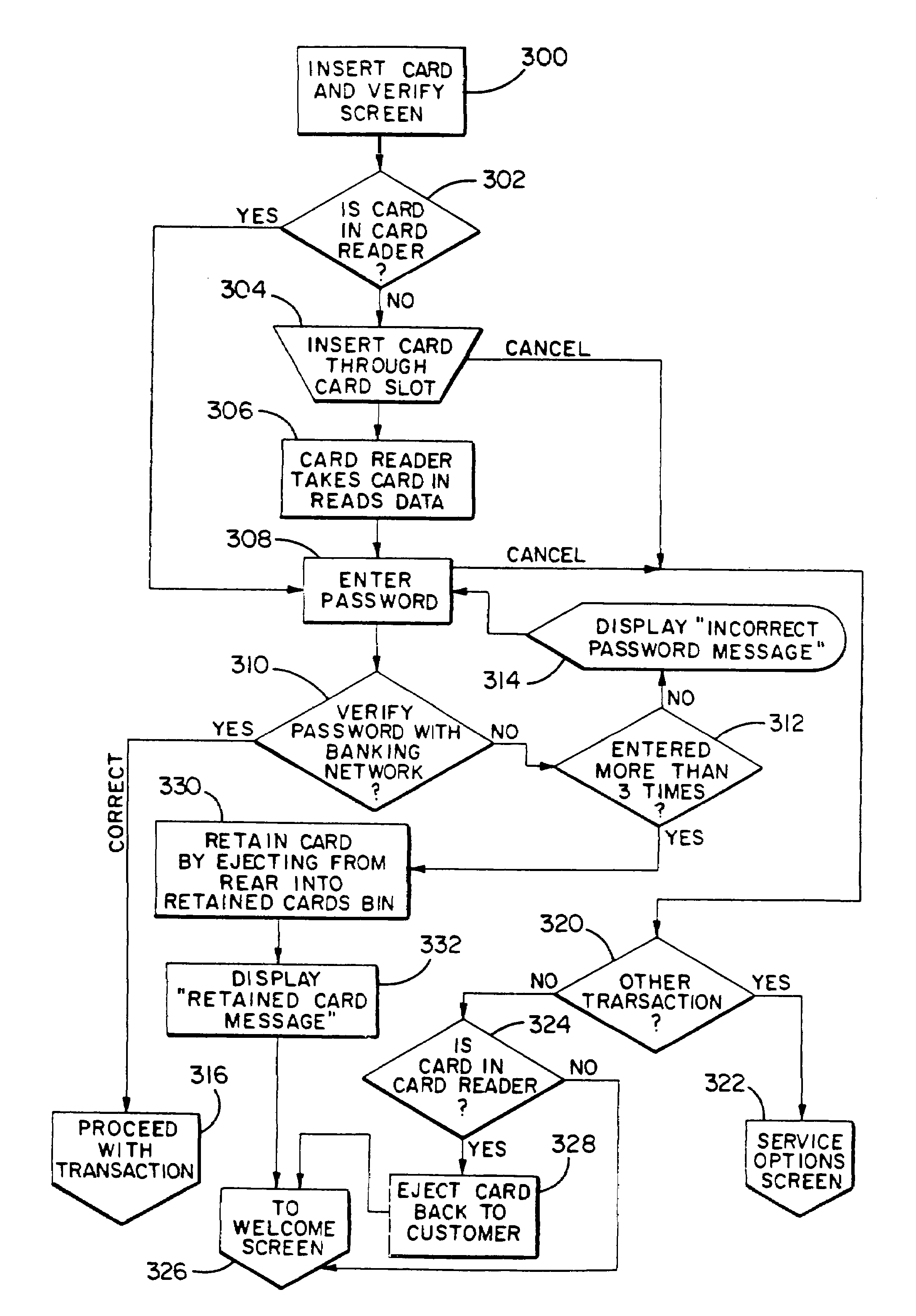

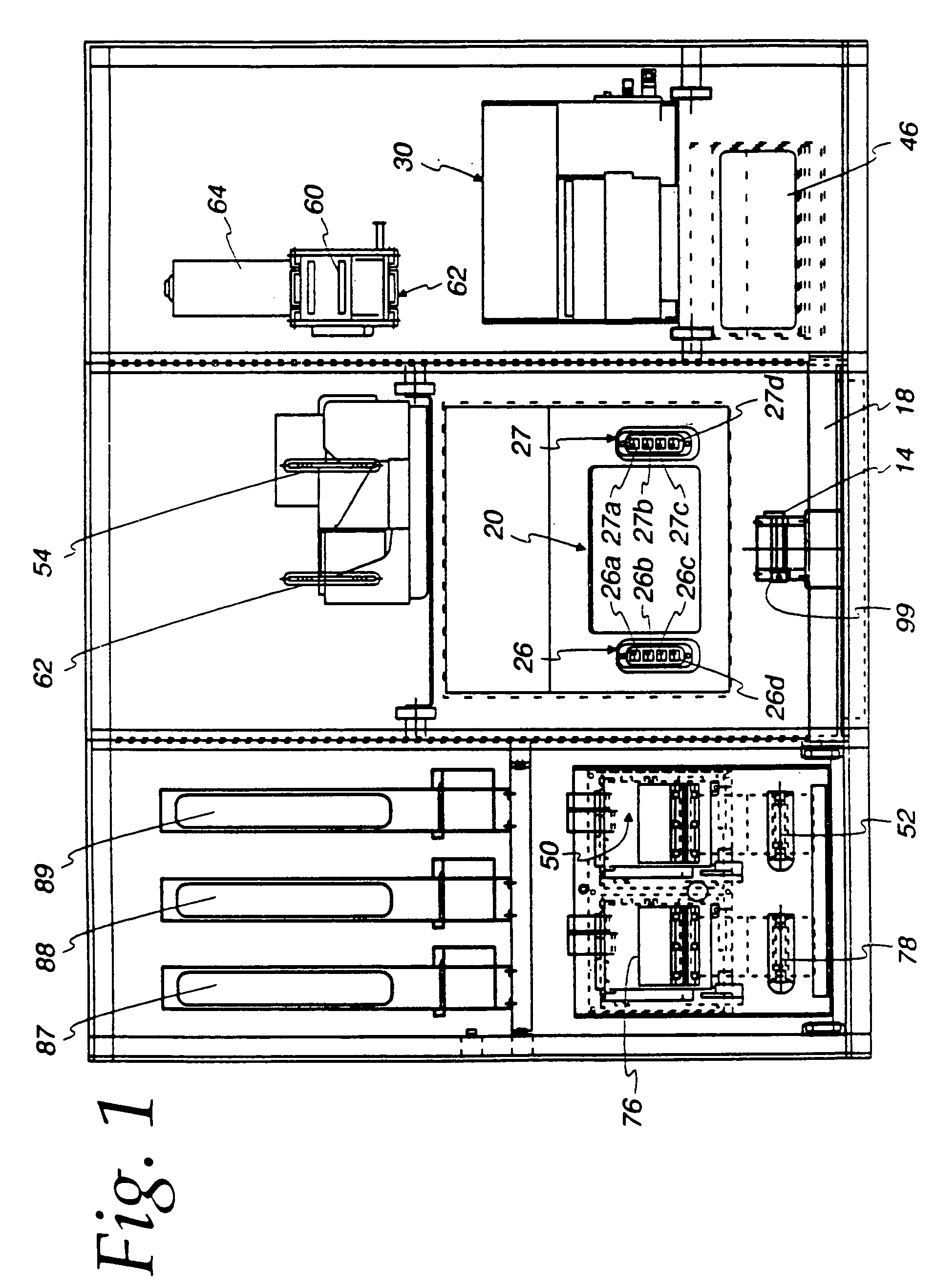

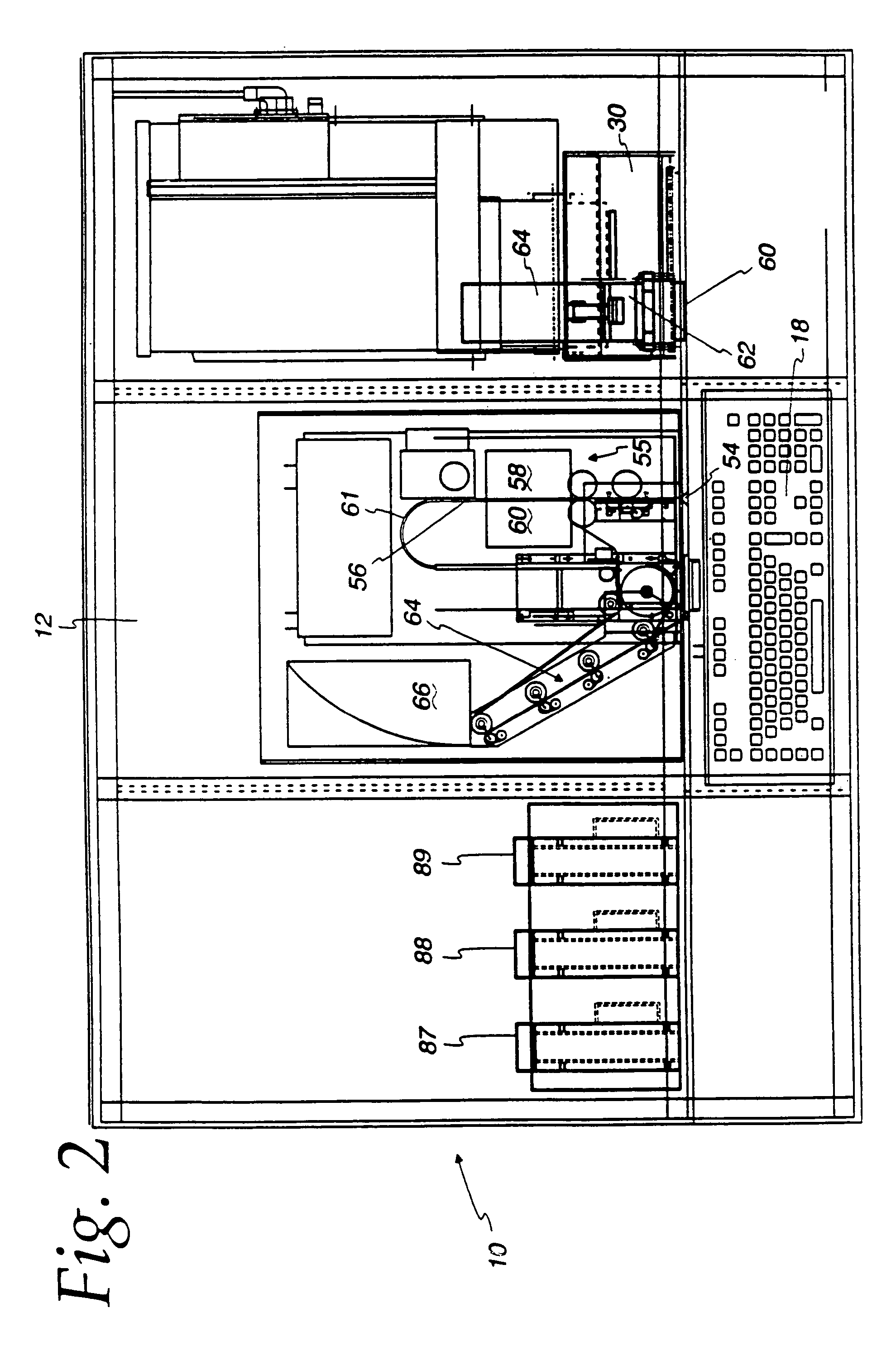

An automated document cashing system is provided with an automated machine that cashes monetary transaction documents such as checks, money orders, and that makes deposit entries into the bank account of the user after validation of the user and monetary transaction document, without the aid of a bank teller. Validation of the identity of the user is performed with the use of a card associated with intelligence that identifies the user. A biometric device also may be used in identifying the validity of the user. Validation of the document involves one or more of: validating the presence of a signature; validating the amount of the monetary transaction document including a manual entry of the amount by the user; validating CAR against the LAR; and validating the banking system parameters and rules for the customer and / or the transaction. To assist in the automatic analysis of data on monetary transactional documents or on remittance documents, the user is prompted to provide a bounding box about the data. An image touch screen may be touched by the user to locate the bounding box and the user may magnify the data to fill the boundary box to exclude other data from this analysis. After document and person validation, the system will dispense money or transfer monies to a savings account, a checking account, a smart card, or the like. The system will also write money orders or wire transfer money. By supplying monies in the form of cash, credit card authorization, smart card balance, or the like to the machine, the user can pay bills such as a utility bill through the system or purchase items dispensed by the system.

Owner:UTILX CORP +2

Automated document cashing system

InactiveUS7653600B2Magnification factor would decreaseAvoid zoom overshootComplete banking machinesFinanceCredit cardBank teller

An automated document cashing system is provided with an automated machine that cashes monetary transaction documents such as checks, money orders, and that makes deposit entries into the bank account of the user after validation of the user and monetary transaction document, without the aid of a bank teller. Validation of the identity of the user is performed with the use of a card associated with intelligence that identifies the user. A biometric device also may be used in identifying the validity of the user. Validation of the document involves one or more of: validating the presence of a signature; validating the amount of the monetary transaction document including a manual entry of the amount by the user; validating CAR against the LAR; and validating the banking system parameters and rules for the customer and / or the transaction. To assist in the automatic analysis of data on monetary transactional documents or on remittance documents, the user is prompted to provide a bounding box about the data. An image touch screen may be touched by the user to locate the bounding box and the user may magnify the data to fill the boundary box to exclude other data from this analysis. After document and person validation, the system will dispense money or transfer monies to a savings account, a checking account, a smart card, or the like. The system will also write money orders or wire transfer money. By supplying monies in the form of cash, credit card authorization, smart card balance, or the like to the machine, the user can pay bills such as a utility bill through the system or purchase items dispensed by the system.

Owner:UTILX CORP +2

System and method for screening for fraud in commercial transactions

InactiveUS7427016B2Prevent improper transactionFinancePaper-money testing devicesBank tellerSystems analysis

A method for screening for potential fraud in commercial paper is provided. For example, a method of the invention comprises steps of presenting a check for cashing to a check cashing agent (e.g., a bank teller); scanning or inspecting the check for data; selecting data for analysis; analyzing selected data with a commercial paper fraud detection system (“CPFDS”); and reporting results of the fraud detection system analysis to the check cashing agent. The commercial paper fraud detection system provides a means for predicting if commercial paper is potentially fraudulent. For example, the commercial paper fraud detection system may detect stolen checks, altered checks, and fabricated or counterfeit checks, among other types of fraud. Also provided is a computer program product for detecting fraud in commercial paper.

Owner:CHIMENTO MARC A

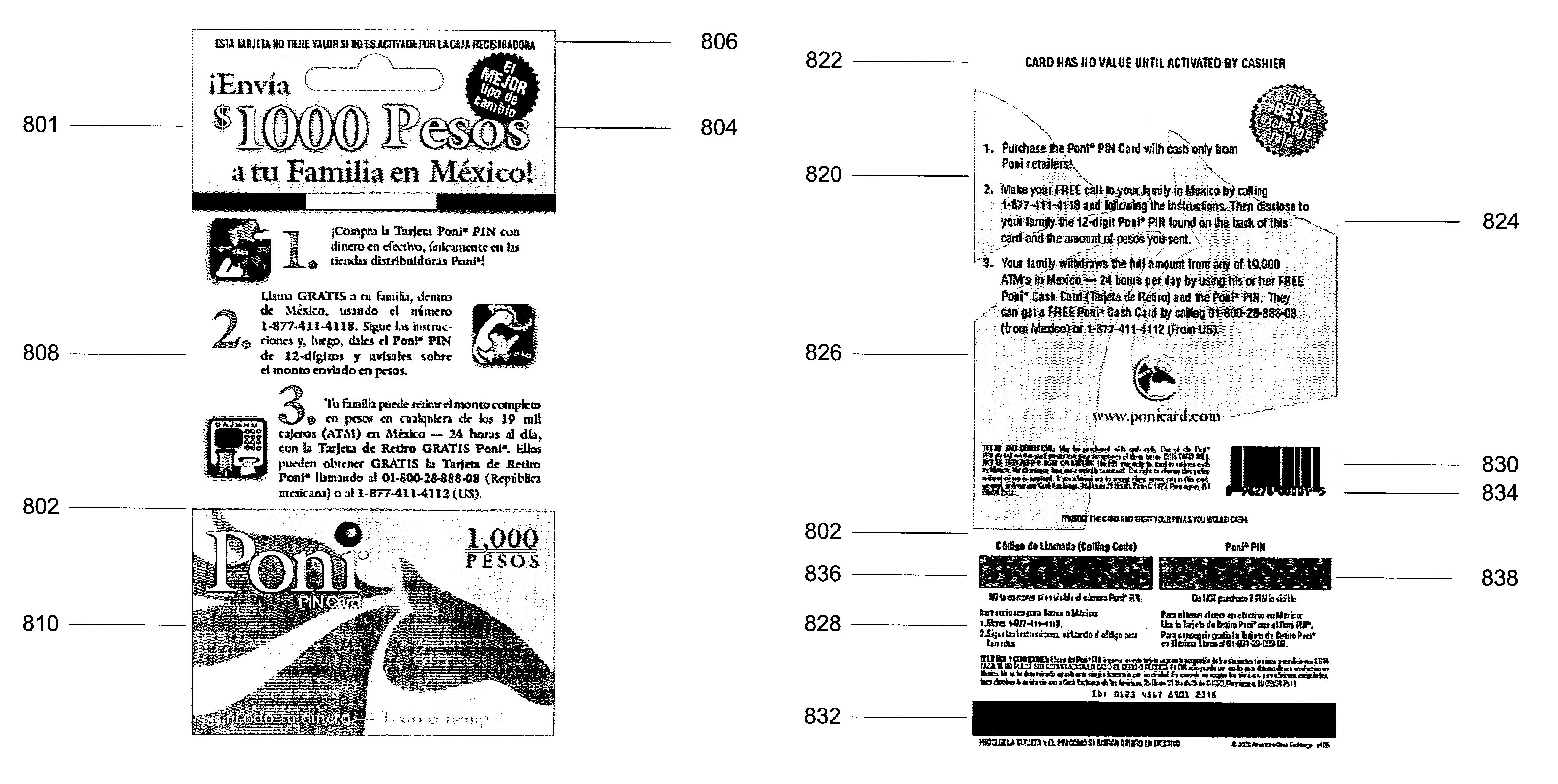

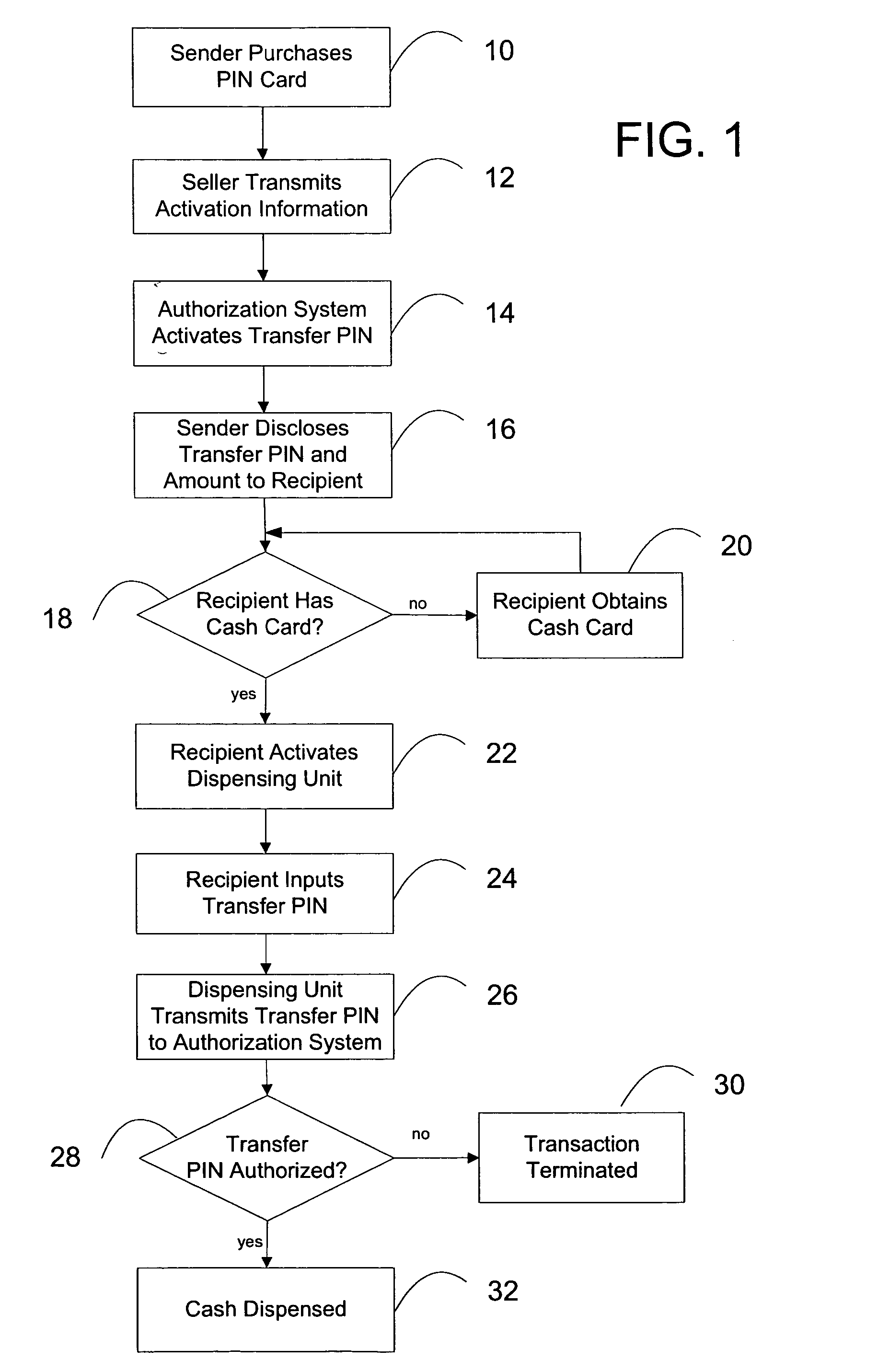

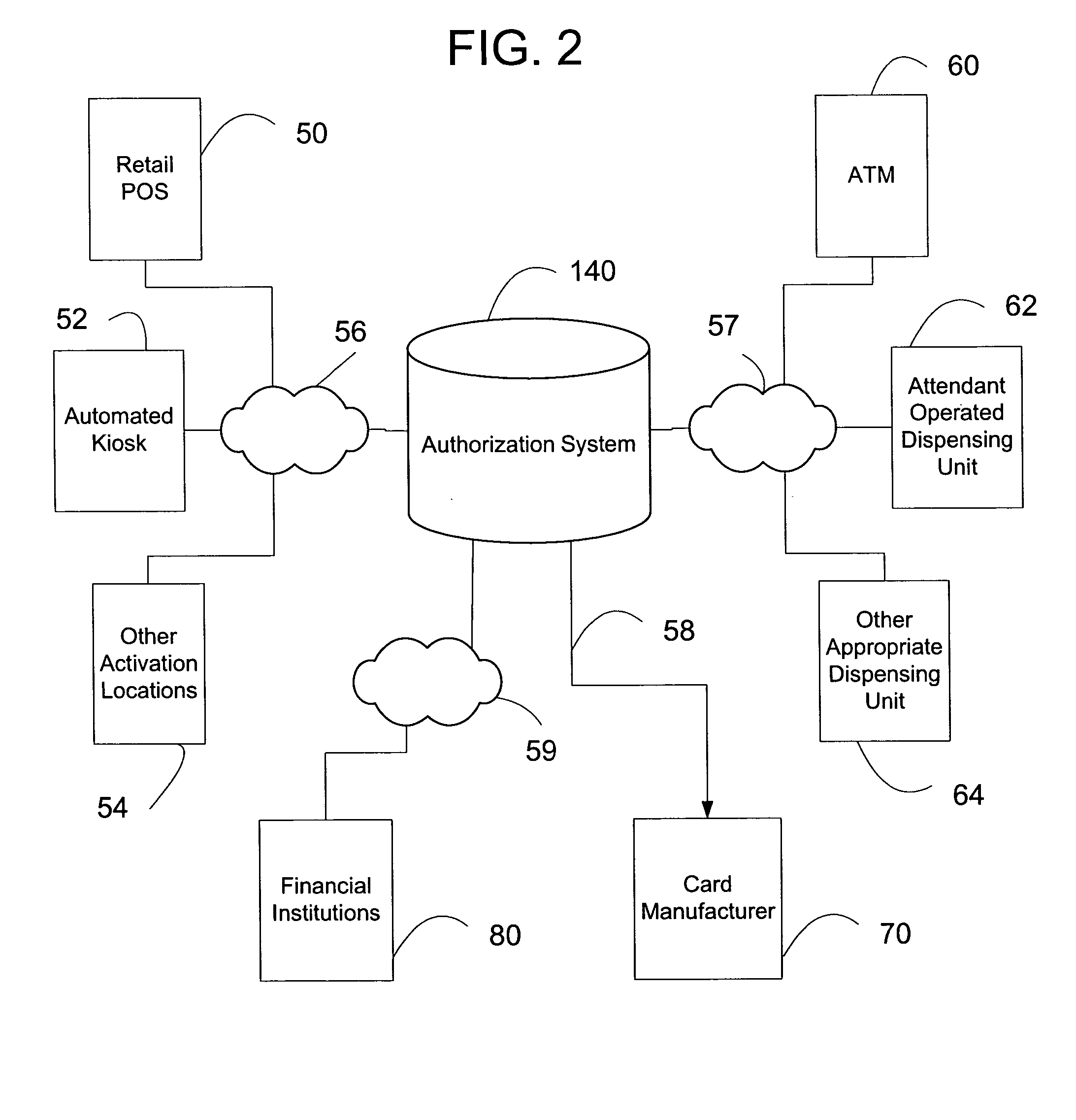

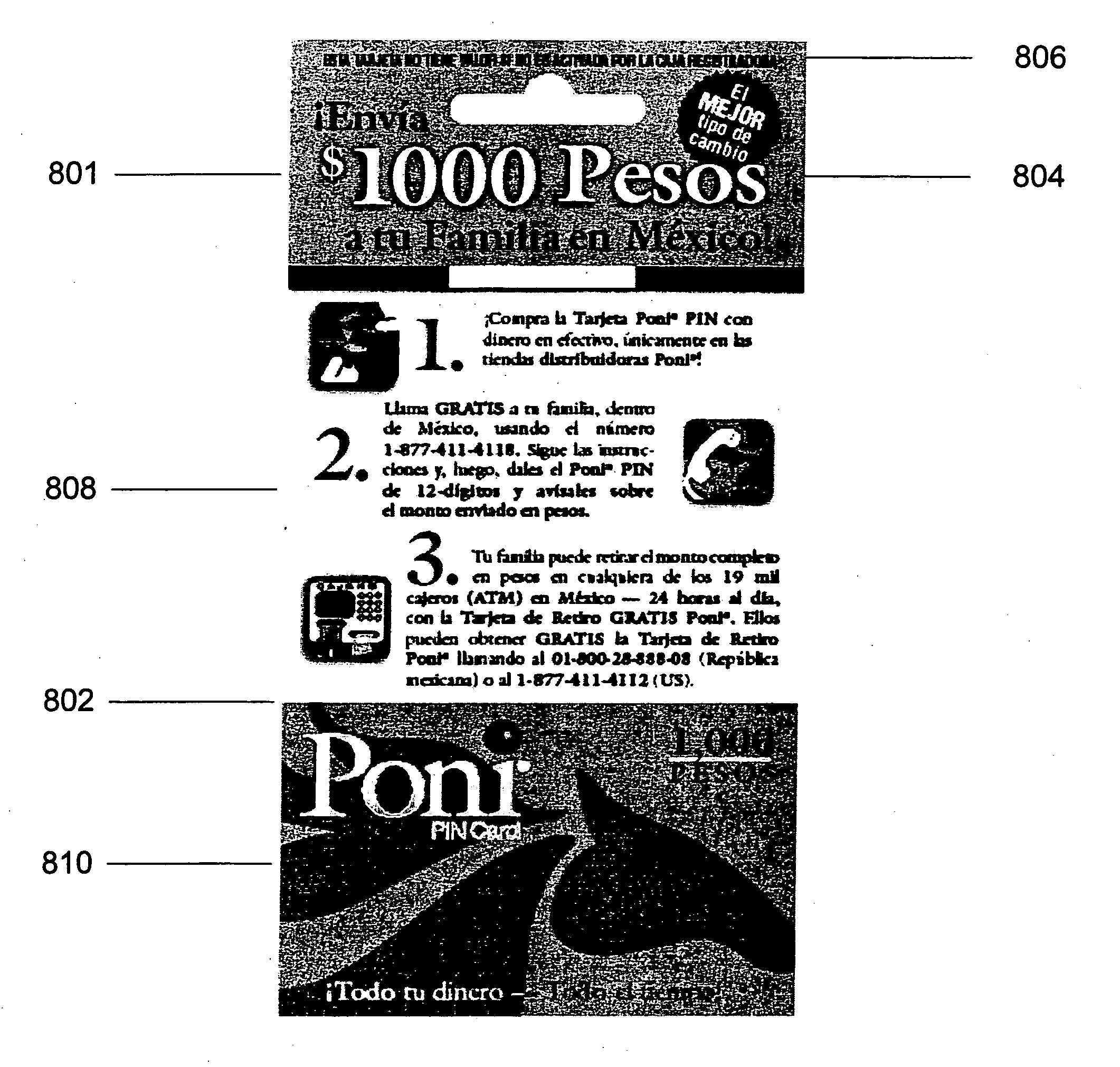

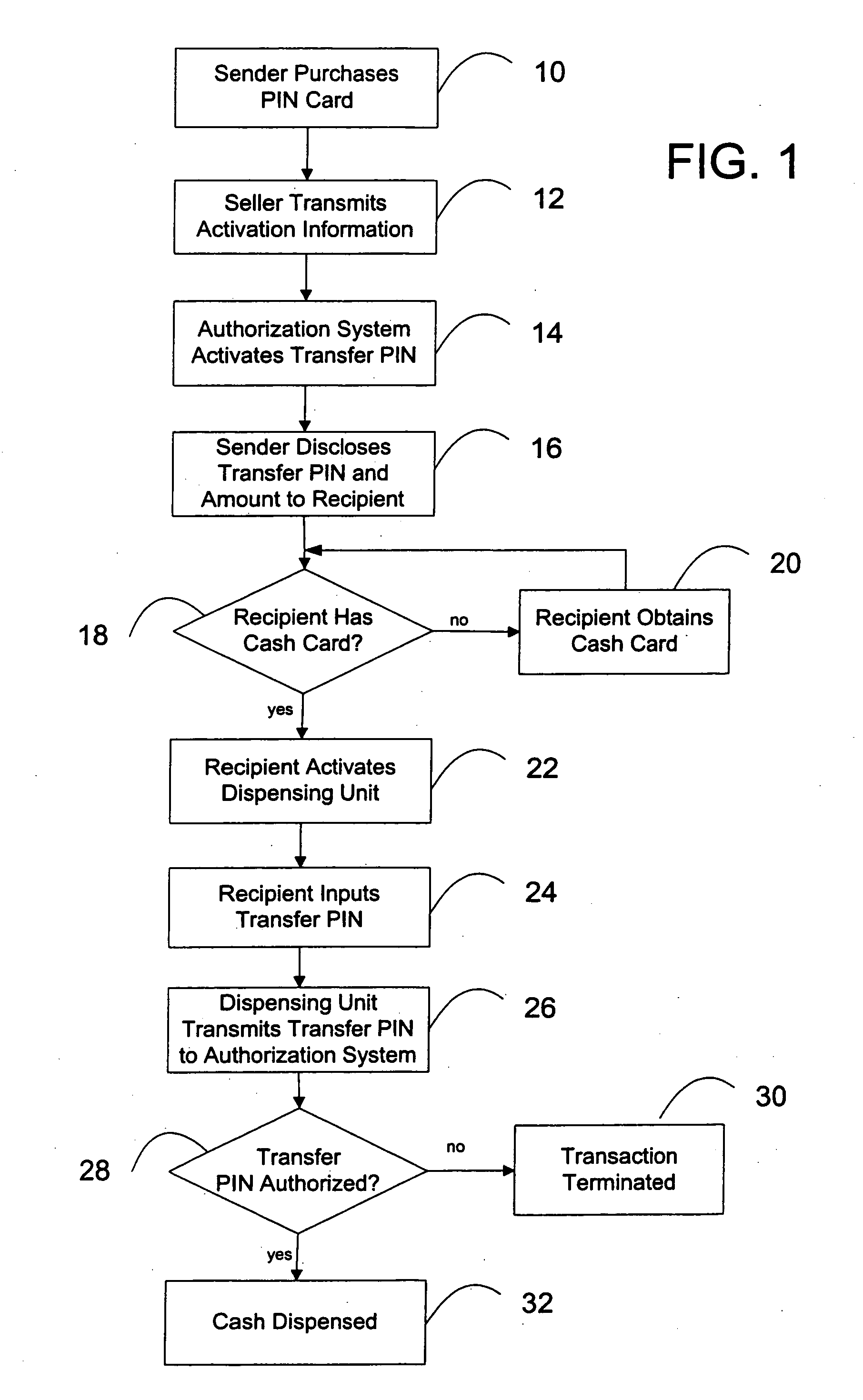

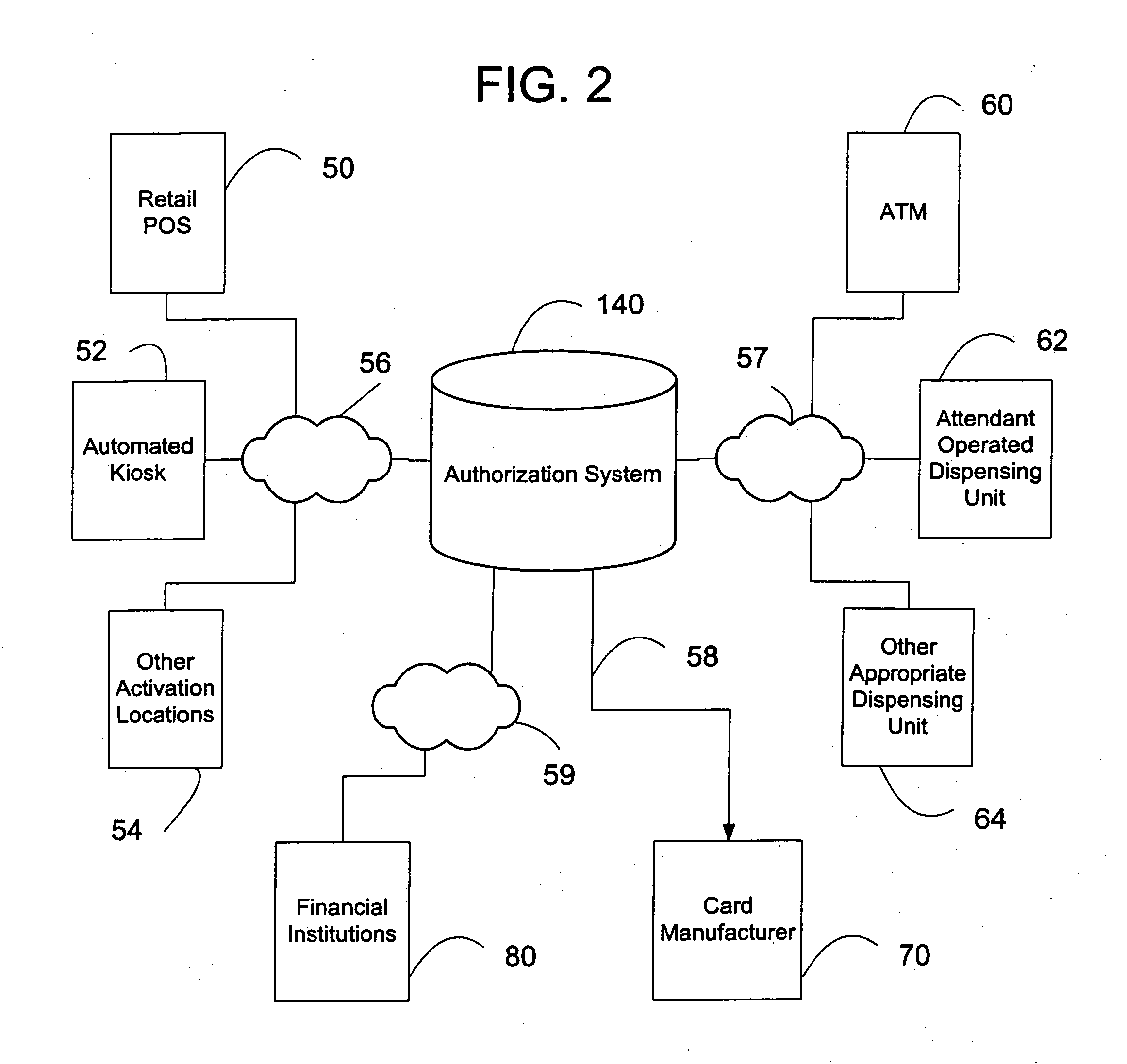

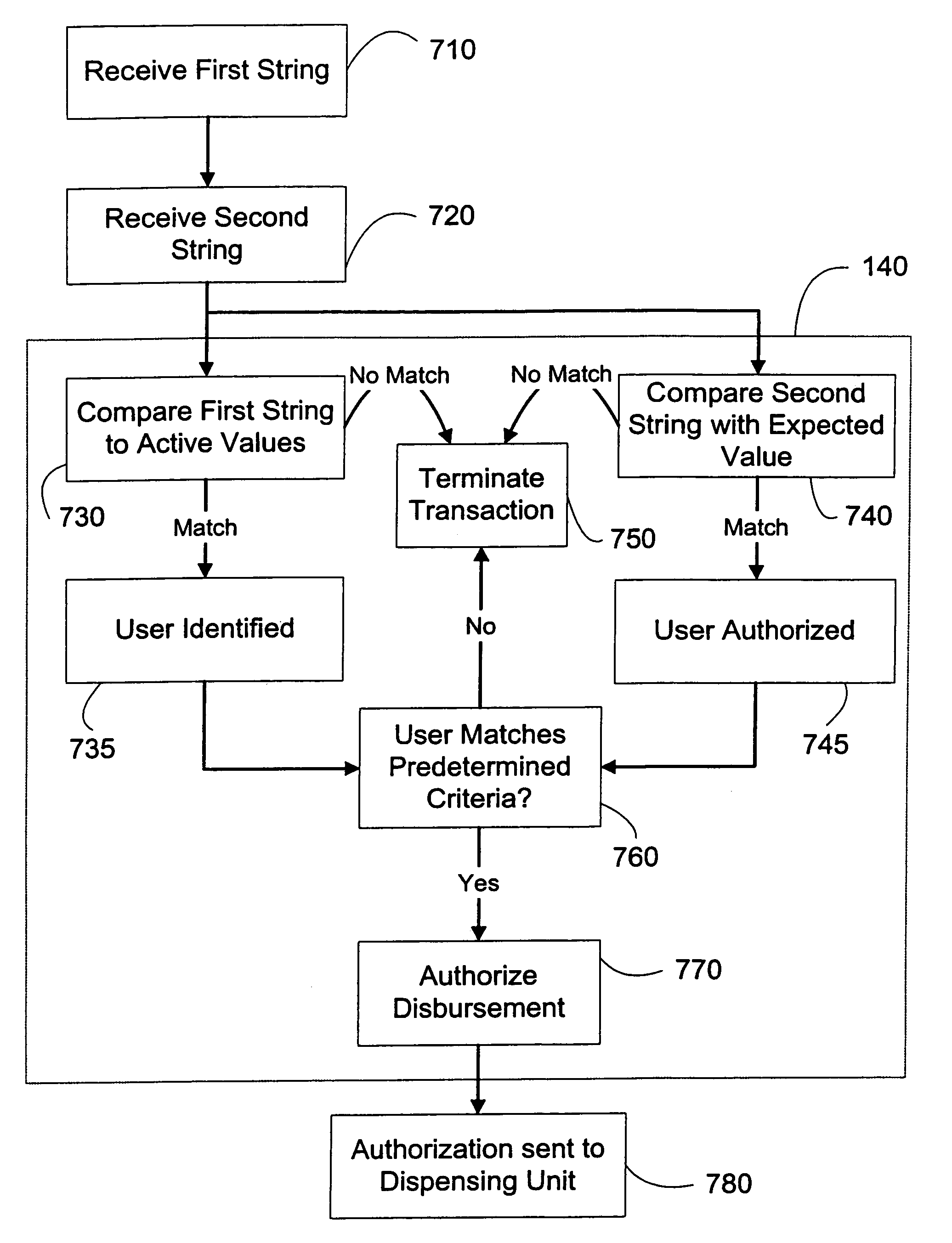

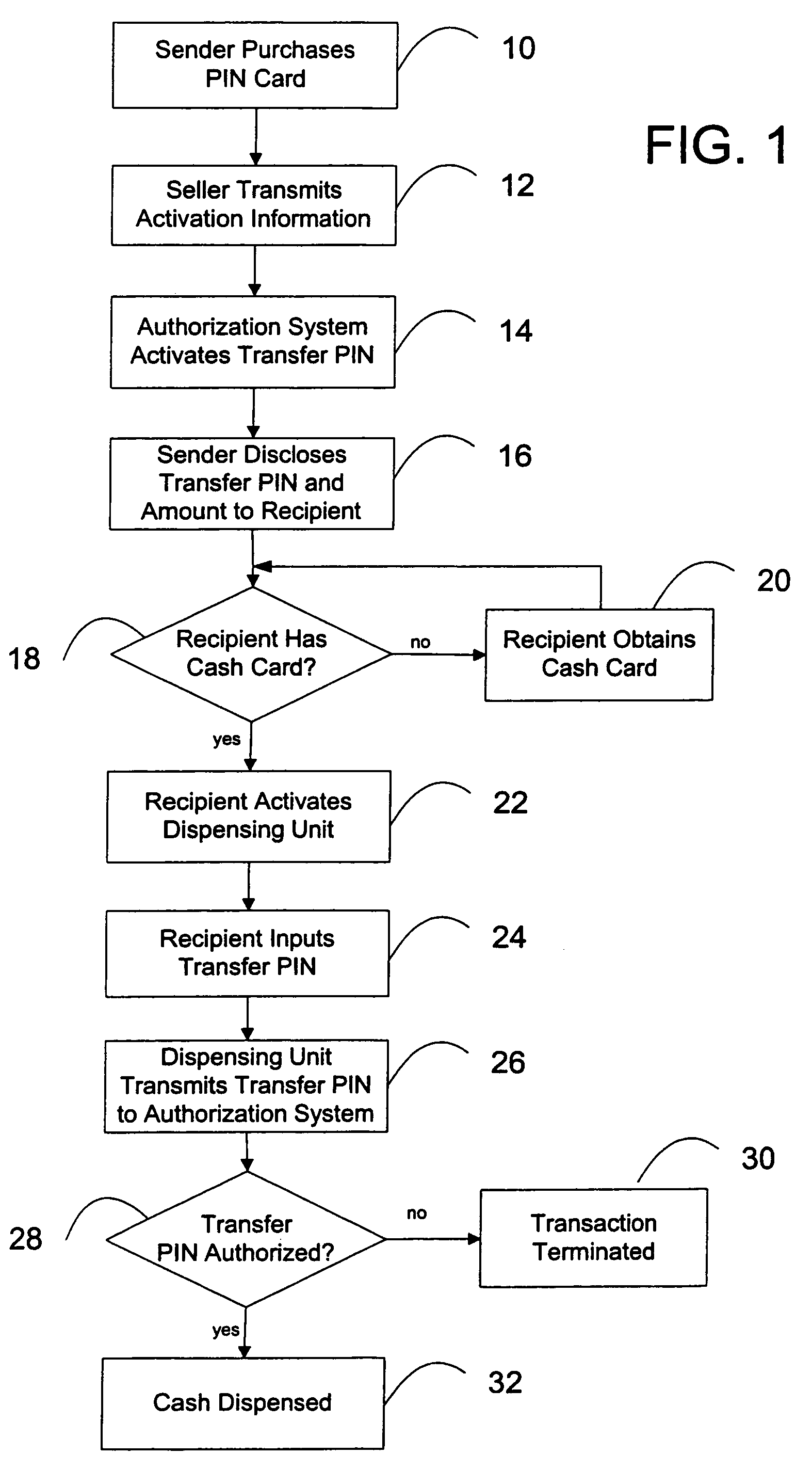

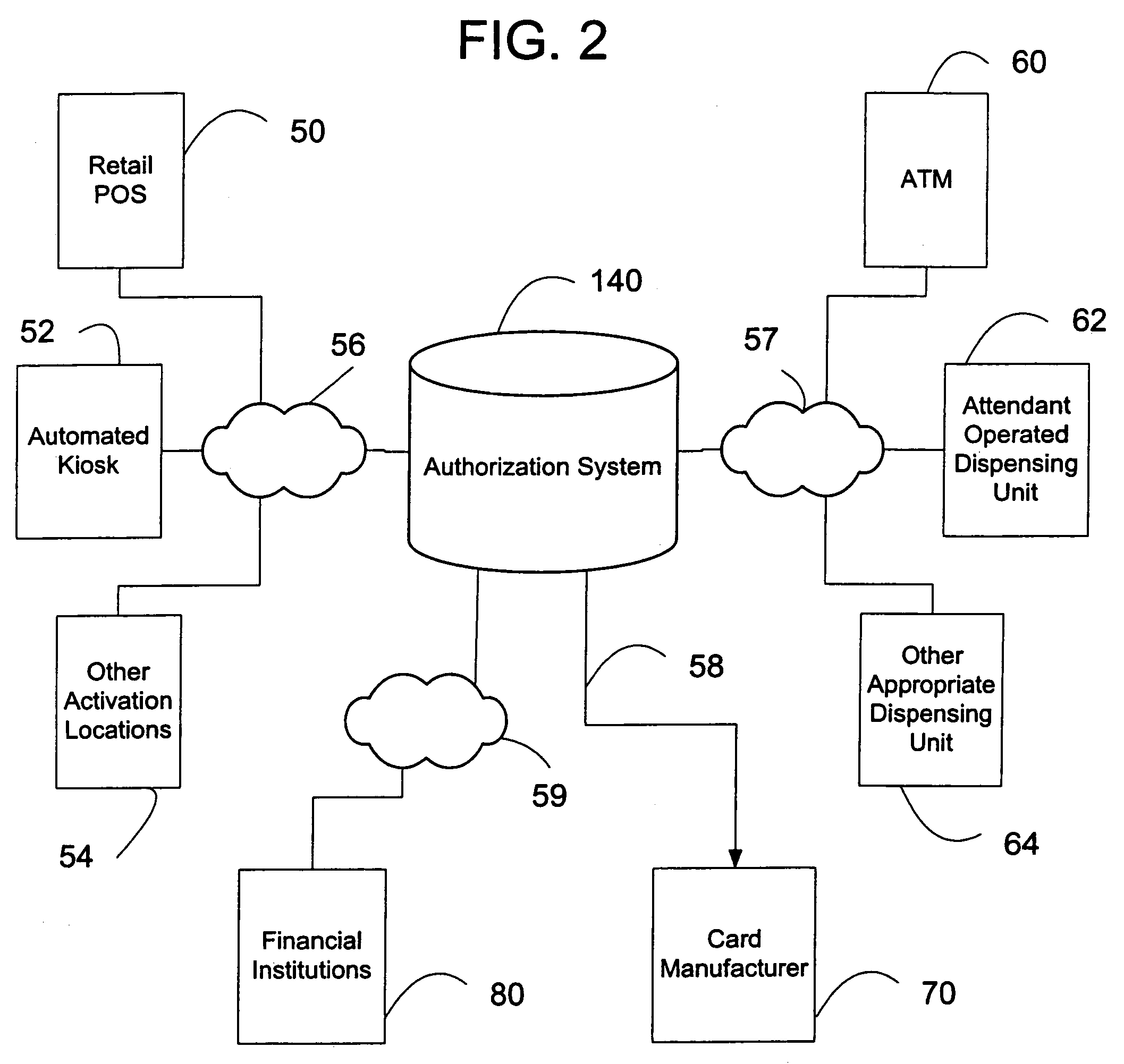

Method and system for automated value transfer

This invention provides a system and method for authorizing automated value transfers from an account available to users who do not have a pre-existing trust, business or financial relationship. In an embodiment of the present invention, a Sender at a first location purchases a PIN Card at a point of sale, such as a retail location or a bank teller. The Sender contacts an intended Recipient at a remote location and discloses a Transfer PIN associated with the PIN Card, as well as the amount being transferred, to that intended Recipient. The Recipient needs only the Transfer PIN and a Cash Card to receive the money transfer at a participating remote location. To receive the value associated with the PIN Card, the Recipient inserts or swipes the Cash Card at an ATM and enters the Transfer PIN. An authorization system then authorizes the dispensing unit to dispense that value amount.

Owner:ACE SERIES A HOLDCO +1

Method and system for automated value transfer

This invention provides a system and method for authorizing automated value transfers from an account available to users who do not have a pre-existing trust, business or financial relationship. In an embodiment of the present invention, a Sender at a first location purchases a PIN Card at a point of sale, such as a retail location or a bank teller. The Sender contacts an intended Recipient at a remote location and discloses a Transfer PIN associated with the PIN Card, as well as the amount being transferred, to that intended Recipient. The Recipient needs only the Transfer PIN and a Cash Card to receive the money transfer at a participating remote location. To receive the value associated with the PIN Card, the Recipient inserts or swipes the Cash Card at an ATM and enters the Transfer PIN. An authorization system then authorizes the dispensing unit to dispense that value amount.

Owner:ACE SERIES A HOLDCO

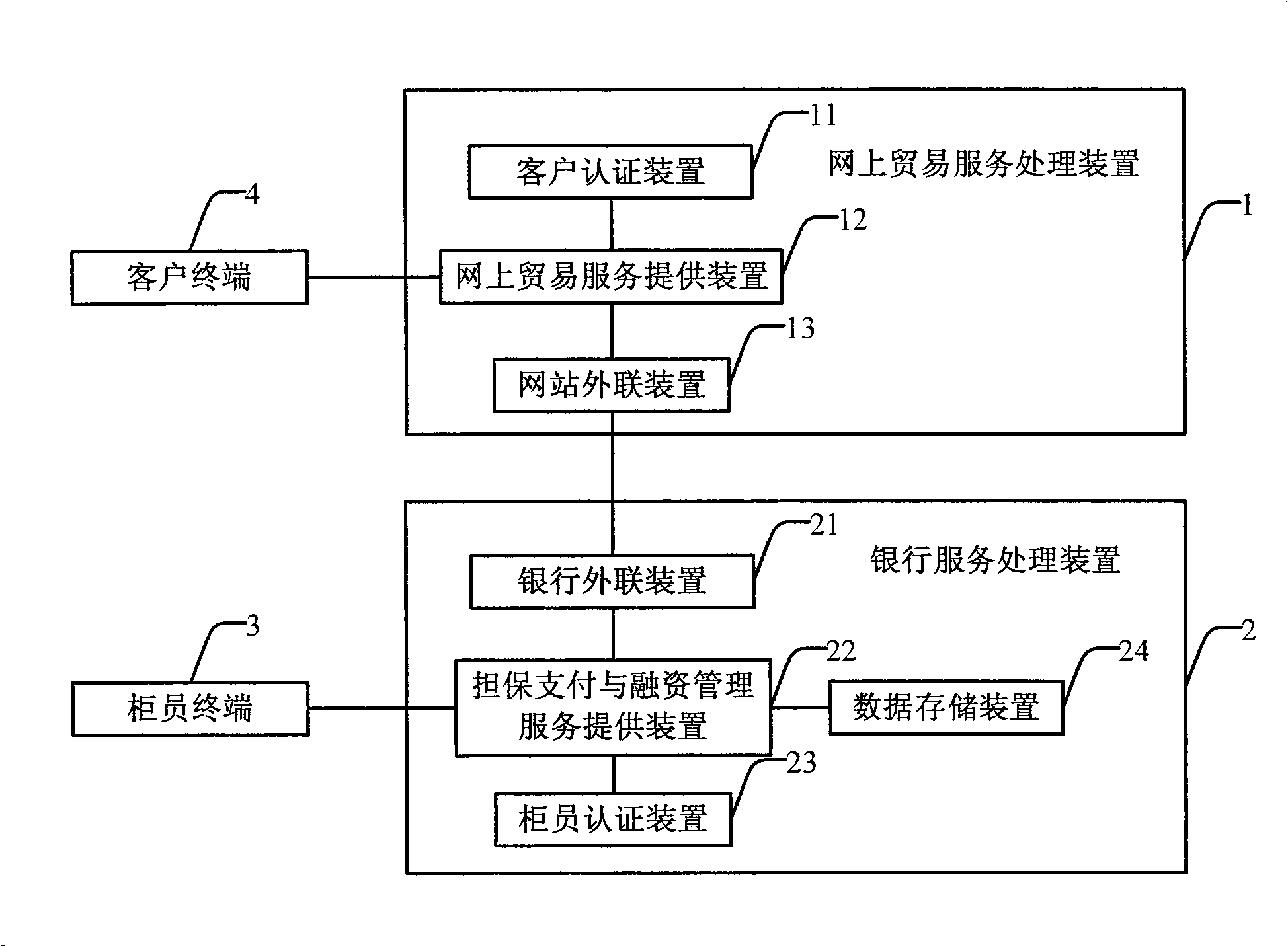

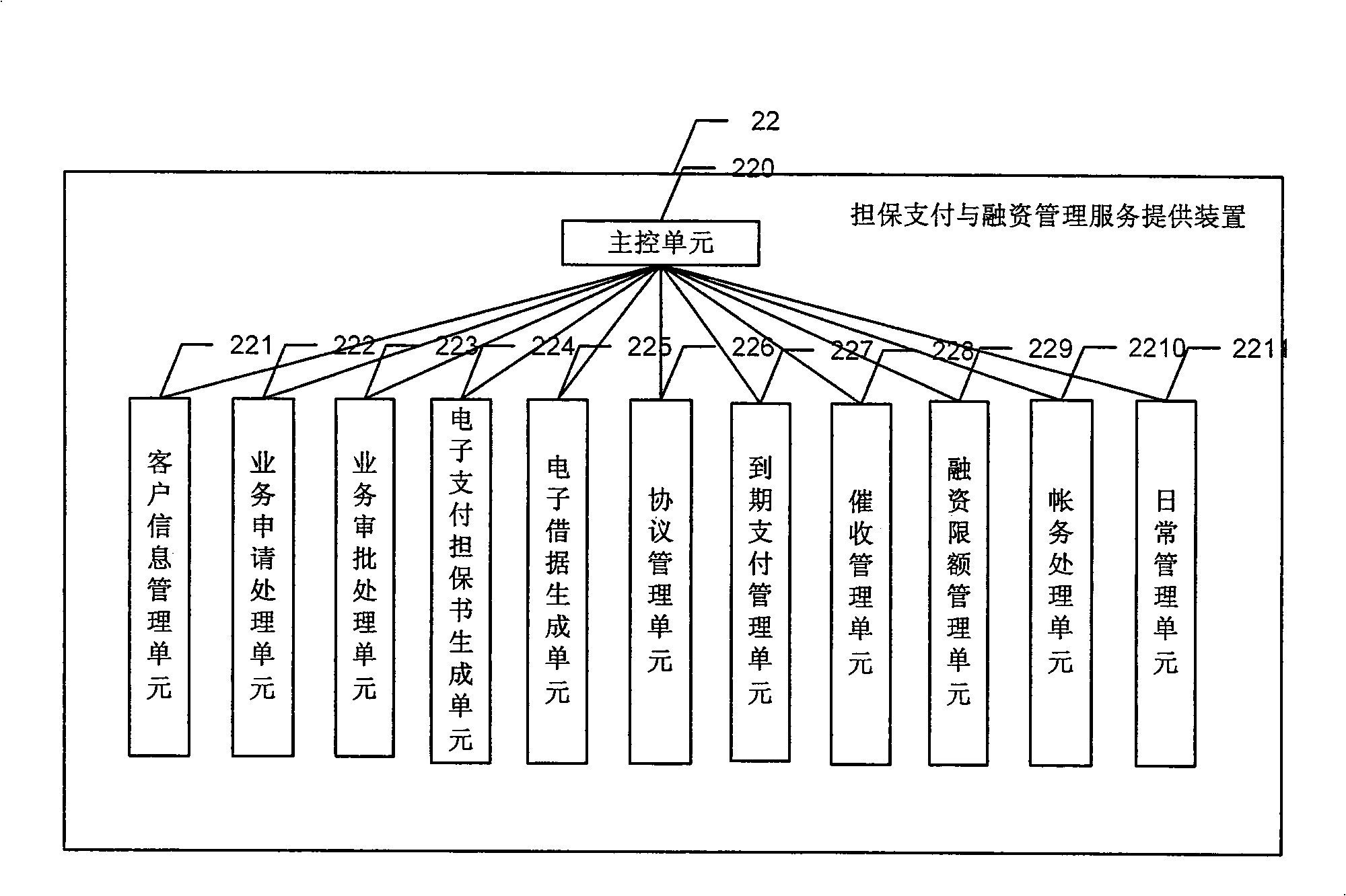

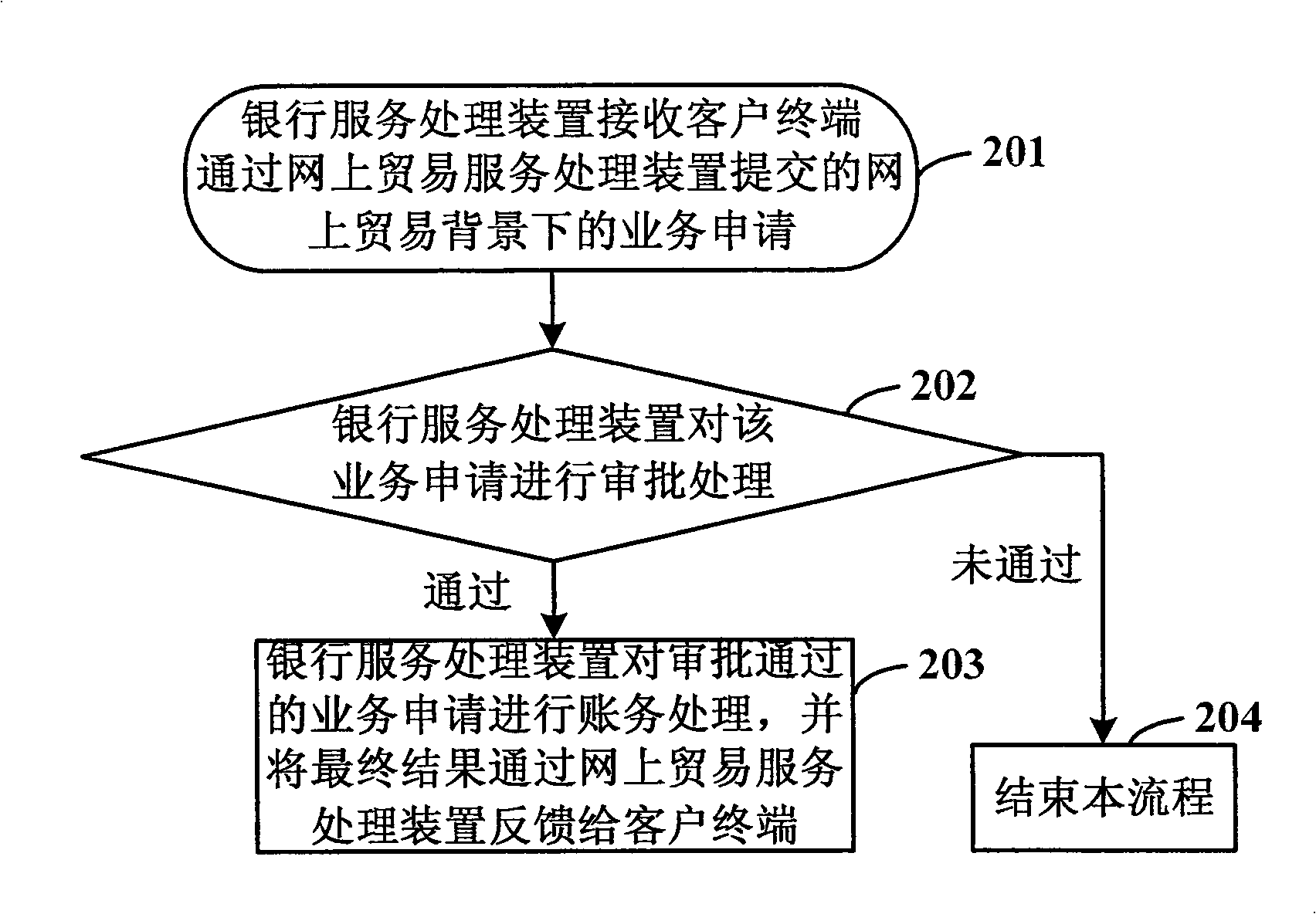

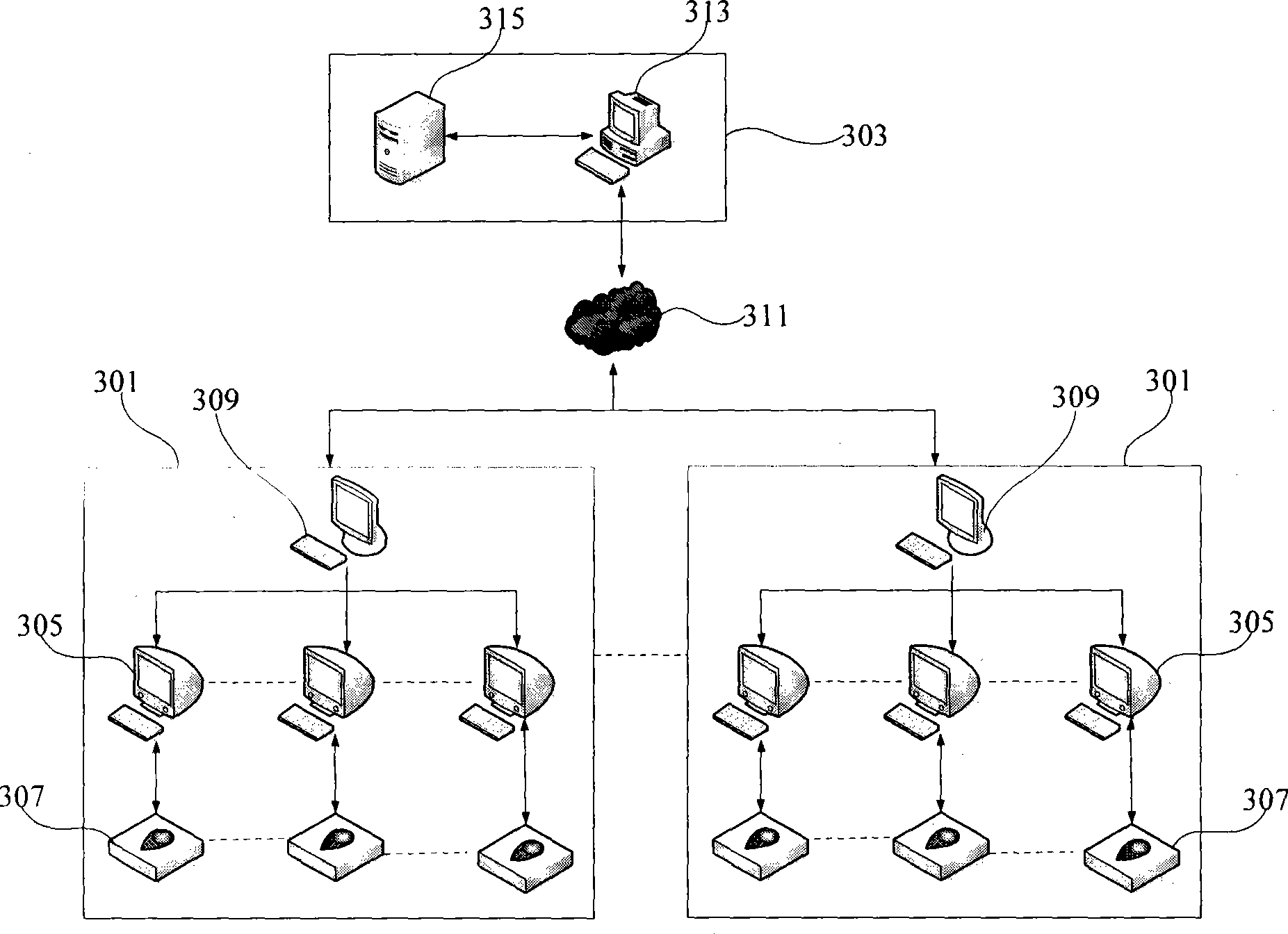

System and method for implementing internet trade guarantee payment and financing

InactiveCN101354765AOvercoming the Defects of Issuing Letters of CreditEnabling fully electronic processingFinancePayment architecturePaymentBank teller

The invention discloses a system capable of realizing online trading guarantee payment and financing. The system comprises an online trading service processing device, a banking service processing device, a teller terminal and a client terminal, wherein the online trading service processing device is used for receiving the access requests from clients, carrying out the client identity authentication and processing the online trading transactions, and is responsible for communicating with a banking system; the banking service processing device is used for communicating with the online trading service processing device, receiving the business requests submitted by the client terminal through the online trading service processing device , receiving the access of the teller terminal, carrying out the authentication for the teller terminal, and realizing the inner business processing flow and accounting treatment of banks; the teller terminal is used for allowing bank tellers to log on the banking service processing device; the client terminal is used for allowing the clients to log on the trade service processing device . The invention discloses a method capable of realizing the online trading guarantee payment and financing. With the invention, the banking guarantee payment and financing can be transacted directly on line, and more convenient services are provided for the online trade.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

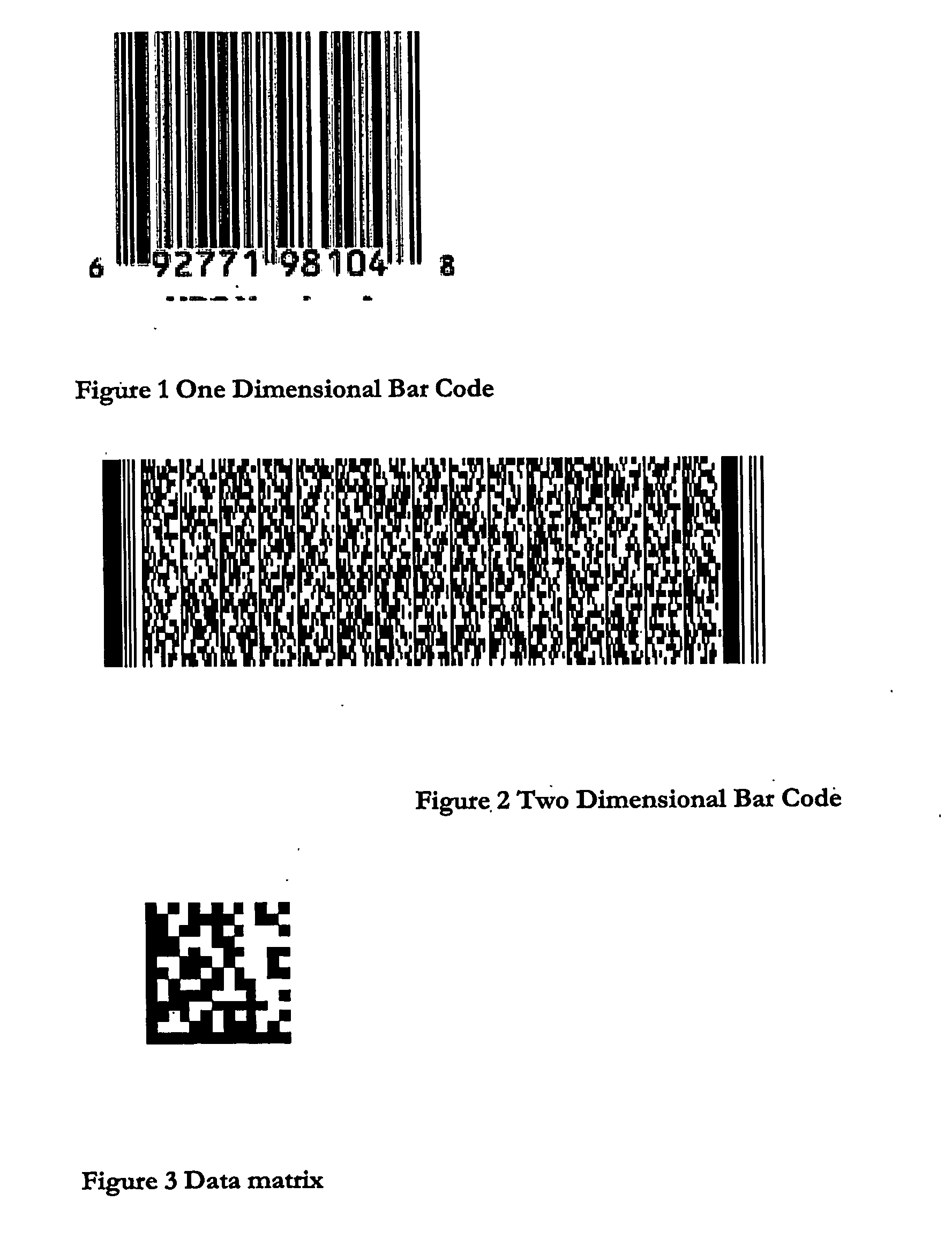

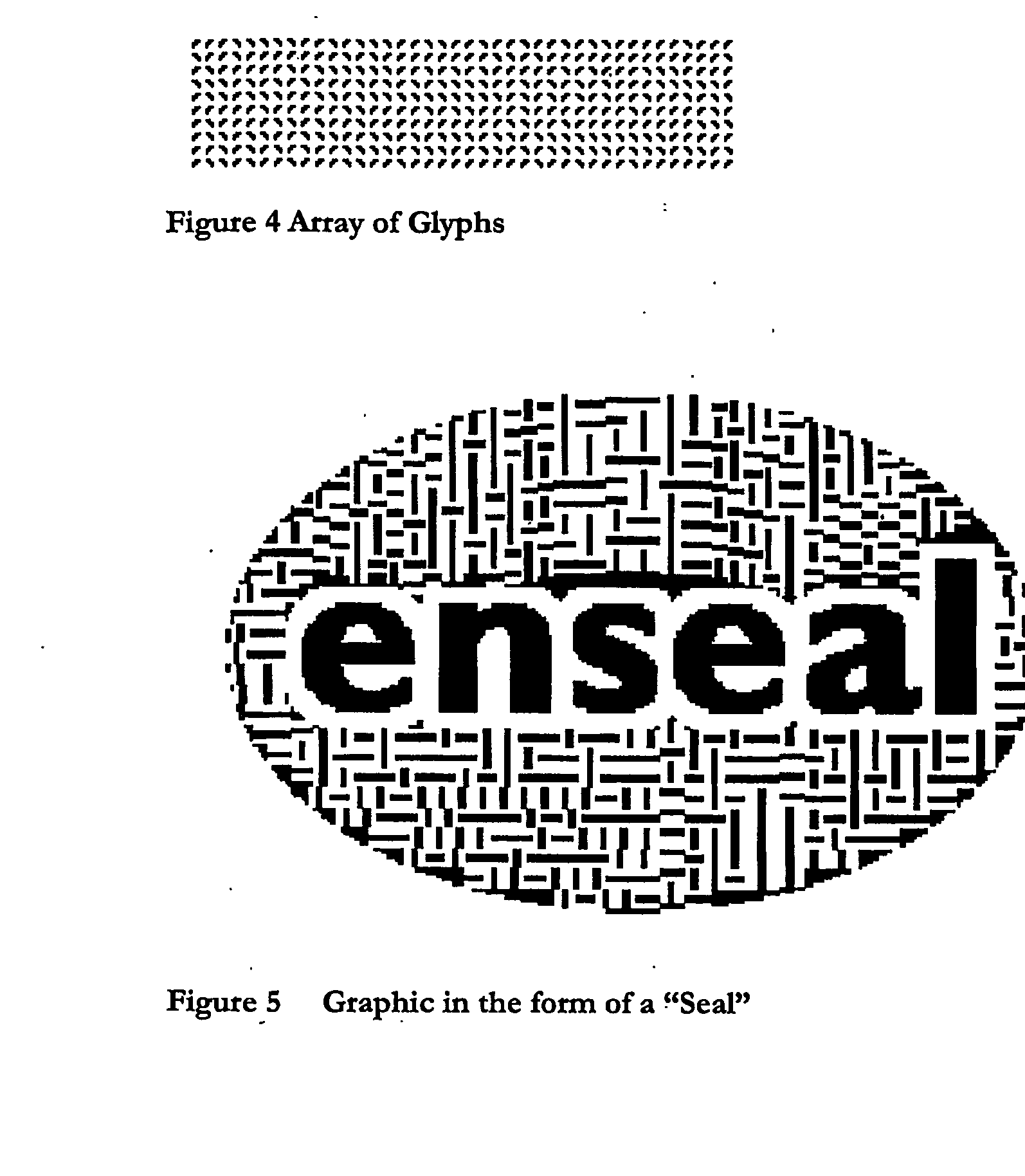

Method of preparing a document so that it can be authenticated

InactiveUS20070088953A1Improve securityImprove security levelPaper-money testing devicesUser identity/authority verificationIssuing bankGraphics

This patent concerns a method of enhancing the security of the check cashing operation at locations remote from the issuing bank. A key suitable for cryptographic purposes is encoded onto the check stock in the form of a graphic where the style of the graphic and its means of interpretation are customisable. This permits the decryption of data without the need for online key retrieval. Typical usage occurs when a check is issued and the payee and amount at least are hashed or encrypted using the key decoded from the graphic, the hashed value being added to the check, possibly on the MICR line. At POS or a bank teller the key is decoded from the graphic, the check data is rehashed and compared with the hash value on the MICR line. The key encoded within the graphic may also be a PIN.

Owner:FISERV CIR

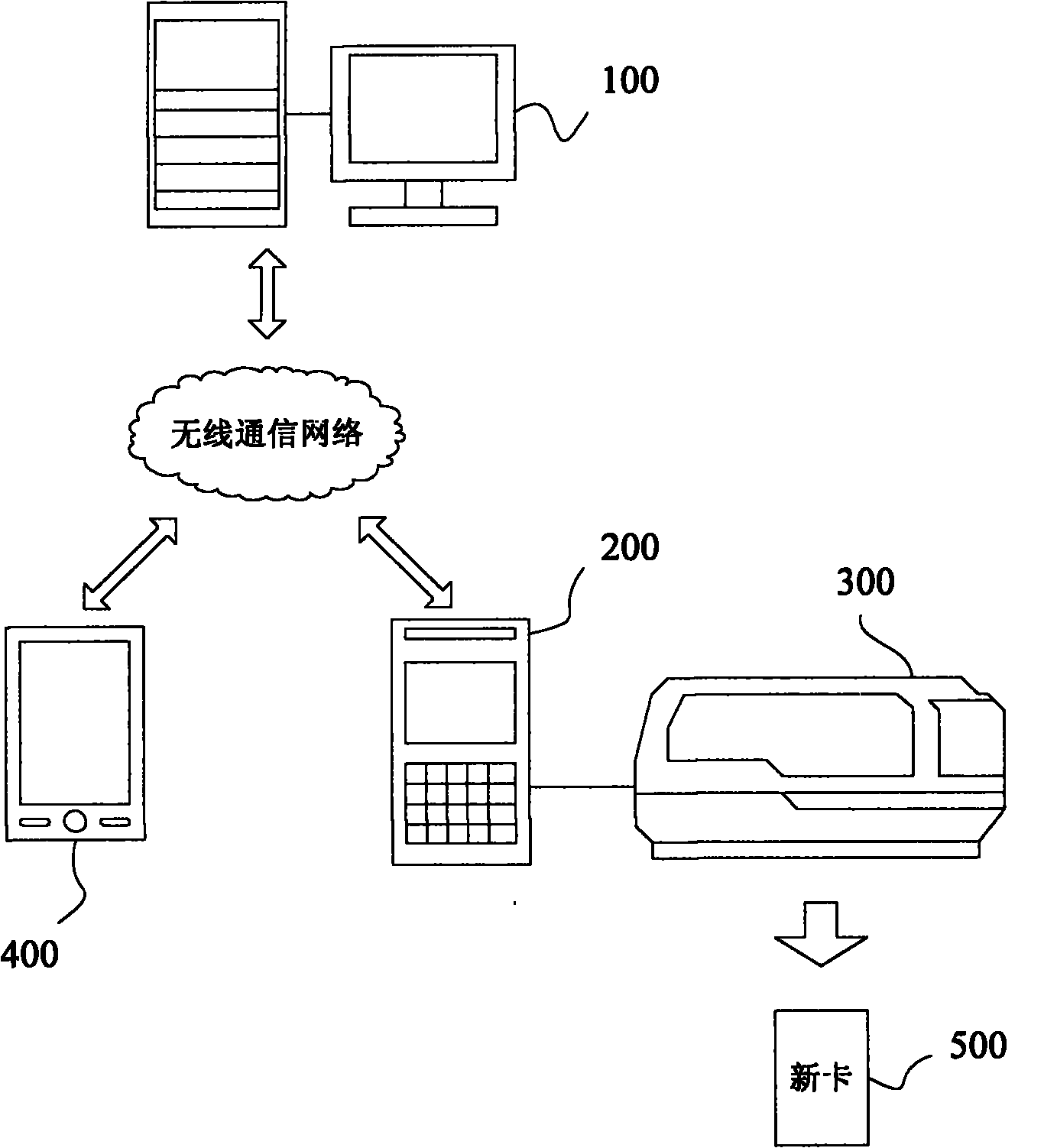

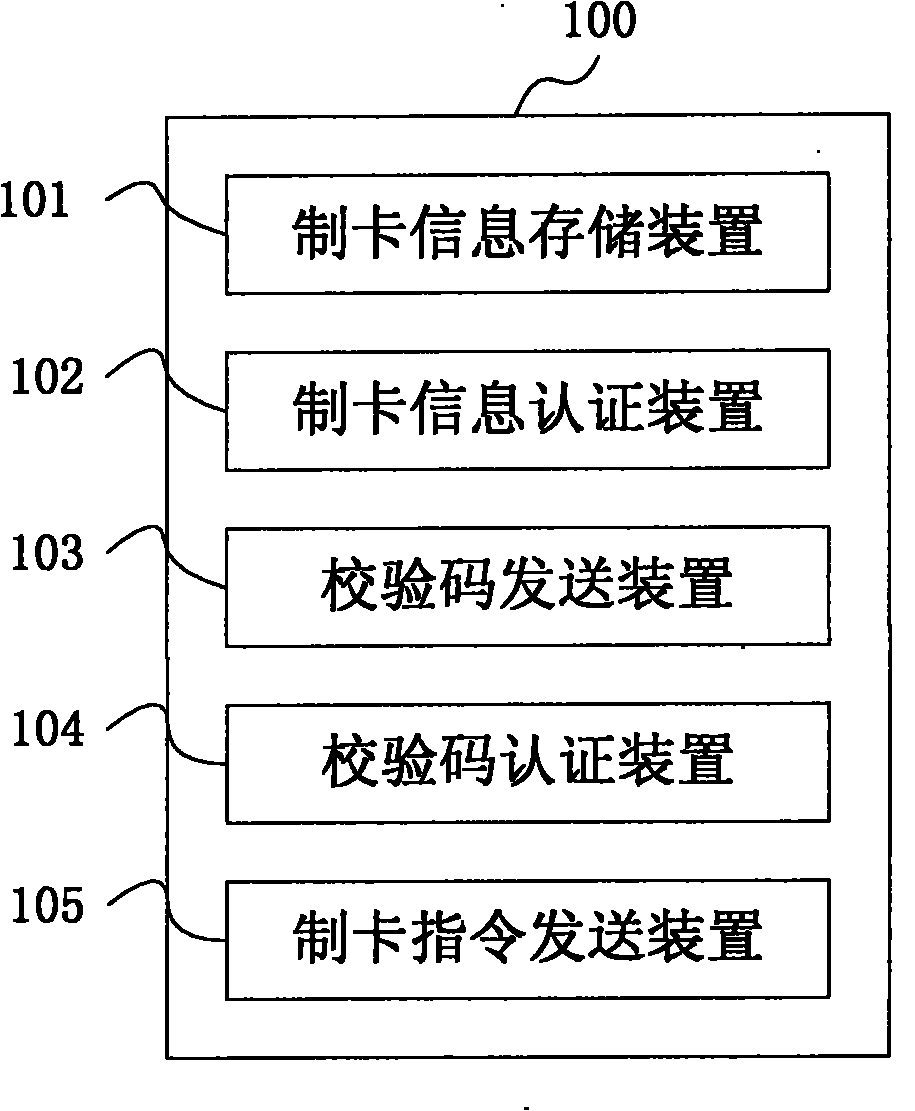

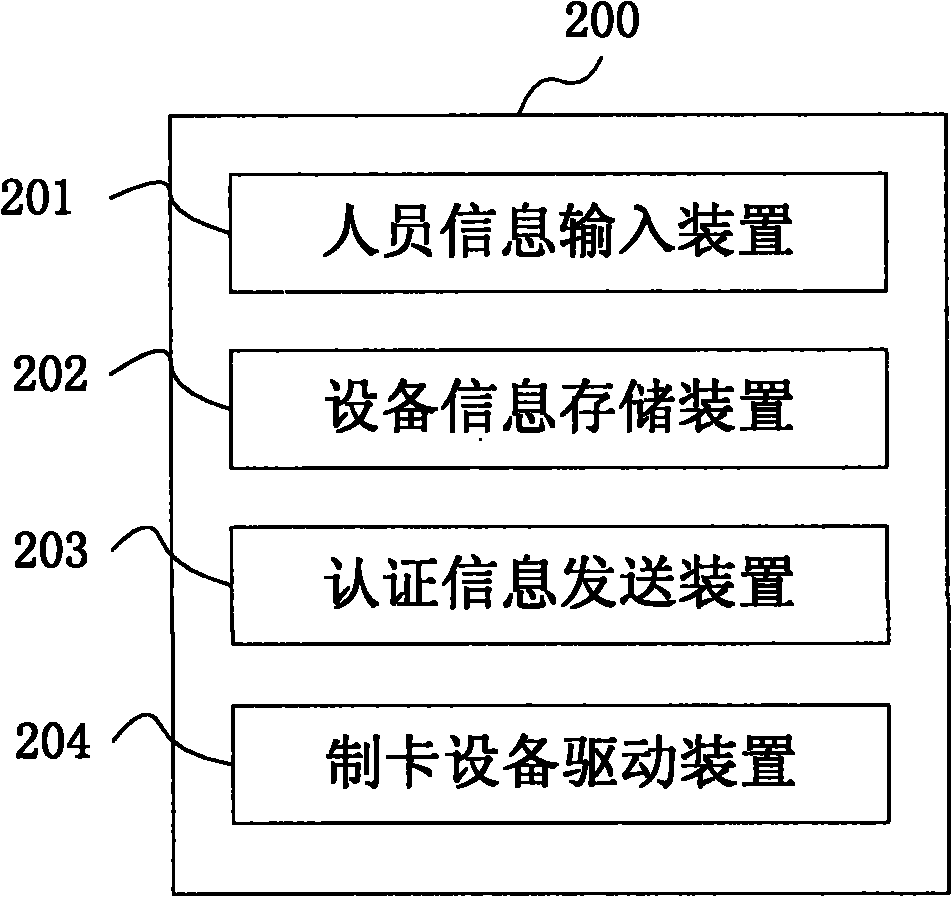

Bank card making system and card exchanging system

InactiveCN101794479AFix security issuesSolve the convenienceCoded identity card or credit card actuationBank tellerCommunication device

The invention provides a bank card making system and a card changing system. The card making system comprises a bank card making server, portable communication equipment and portable card making equipment, wherein the bank card making server is connected with the portable communication equipment through a communication network, and the portable communication equipment is connected with the portable card making equipment; and the bank card making server comprises a card making information storage device, a card making information certification device, a check code sending device, a check code certification device and a card making instruction sending device, and the portable communication equipment comprises a personnel information input device, an equipment information storage device, a certification information sending device and a card making equipment driving device. The invention aims to solve the problems that bank tellers make and change cards door to door, and improves the safety and convenience of card making and changing.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

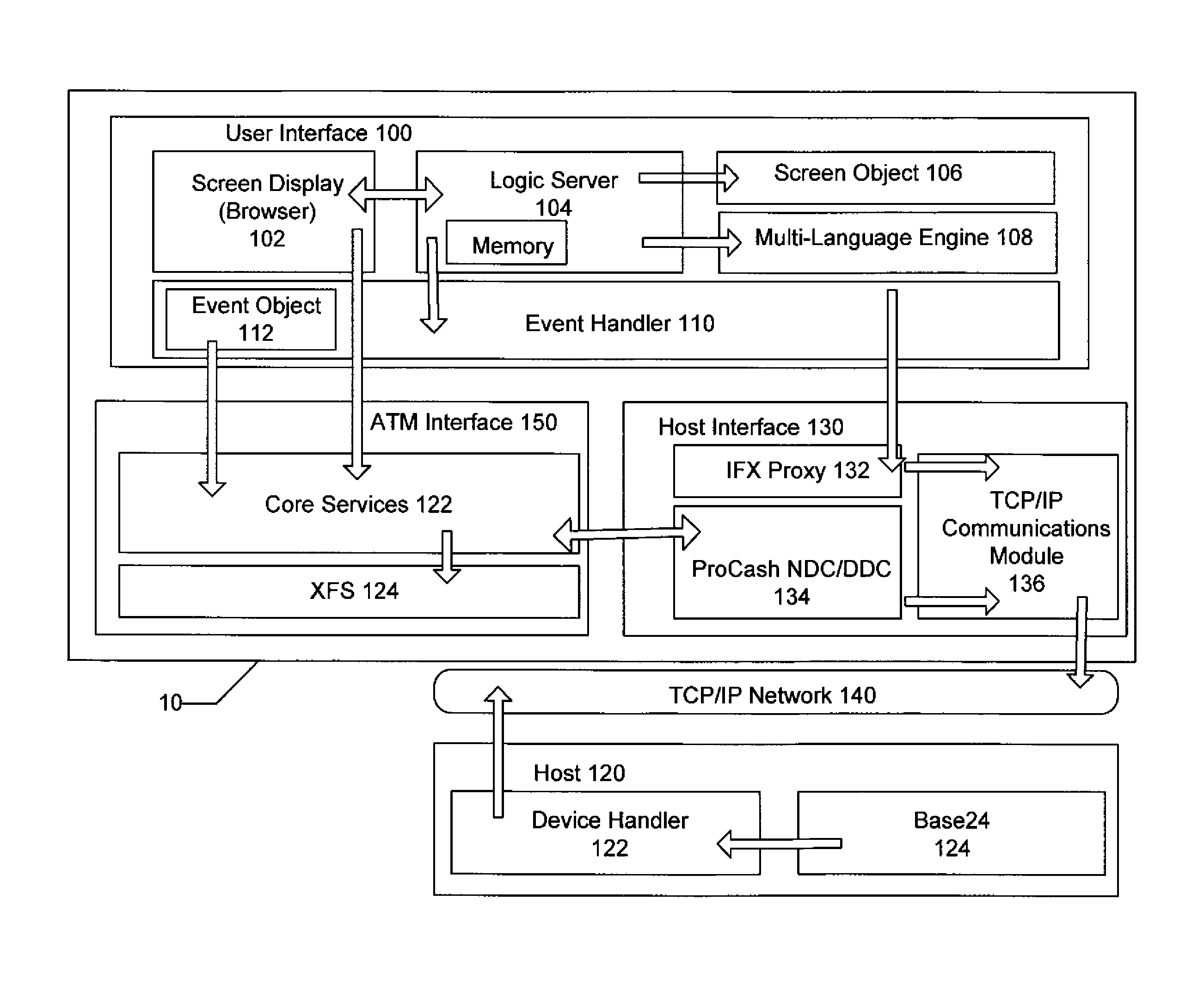

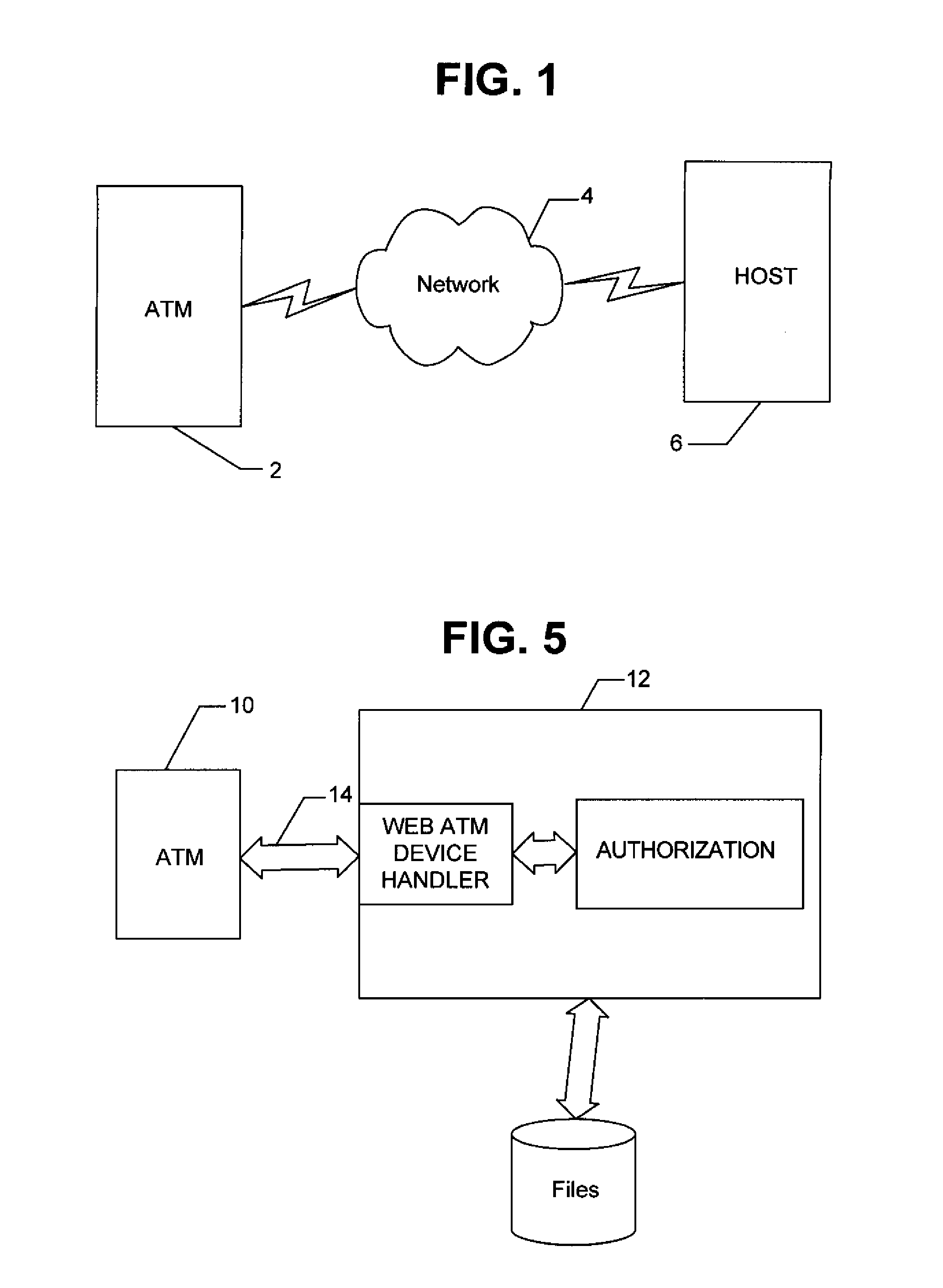

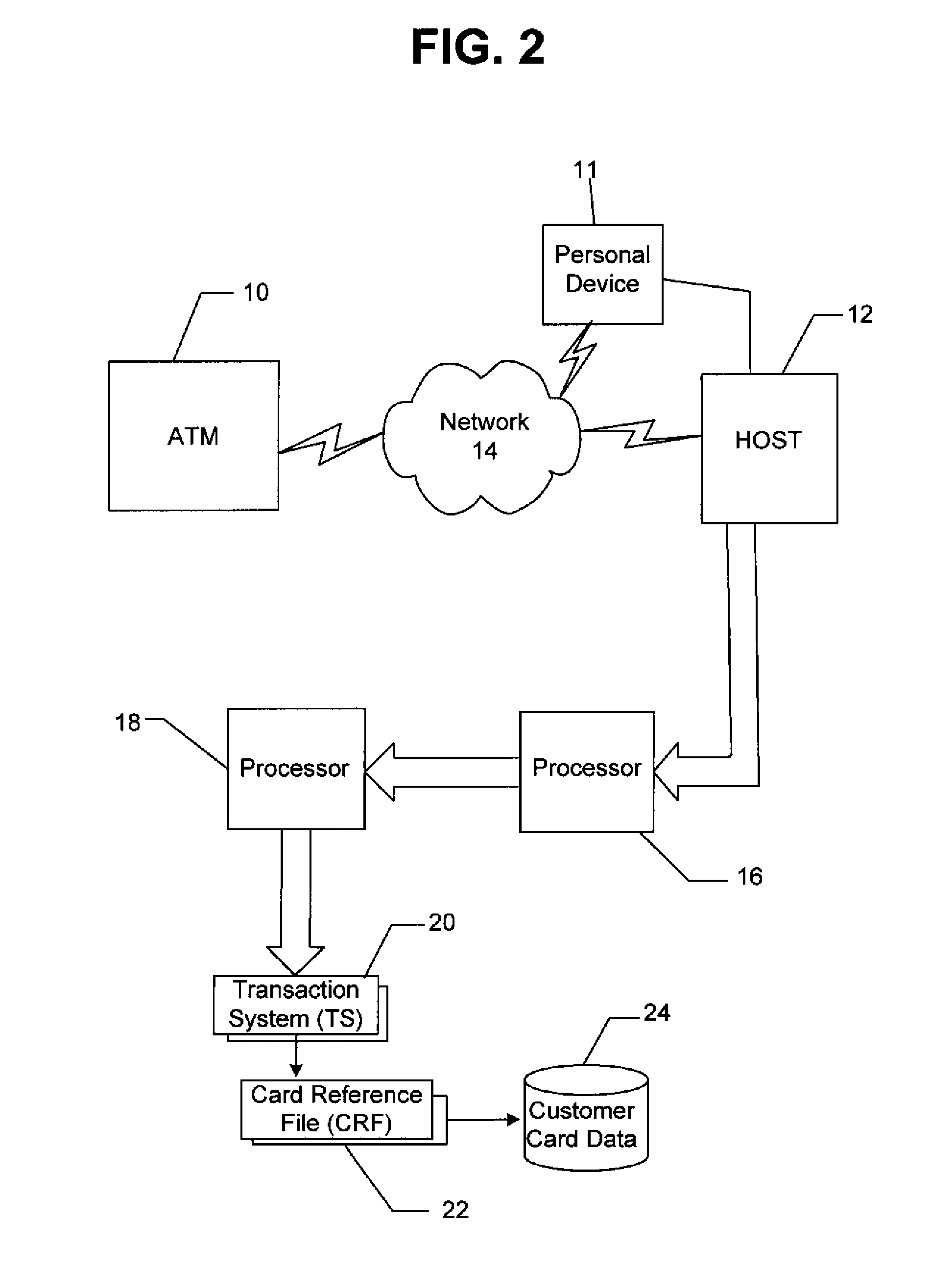

Personalized bank teller machine

A system and method is provided for an ATM having a display, a logic server coupled to the display, and a memory coupled to the logic server. The logic server dynamically controls the functions available to the users including messages and coupons. A host contains a profile of a user. The memory, which is accessible to the logic server, may contain a profile of at least one user. A user card may contain a profile of the user. In operation, the ATM detects the a user's card and requests the profile of the user whose card was detected from a host. The ATM then receives the user's profile and stores the user's profile in the ATM. The system and method also provides a cardless ATM in which a user logs on without a card. Additionally, system and method also provides ATM services via a personal device.

Owner:JPMORGAN CHASE BANK NA

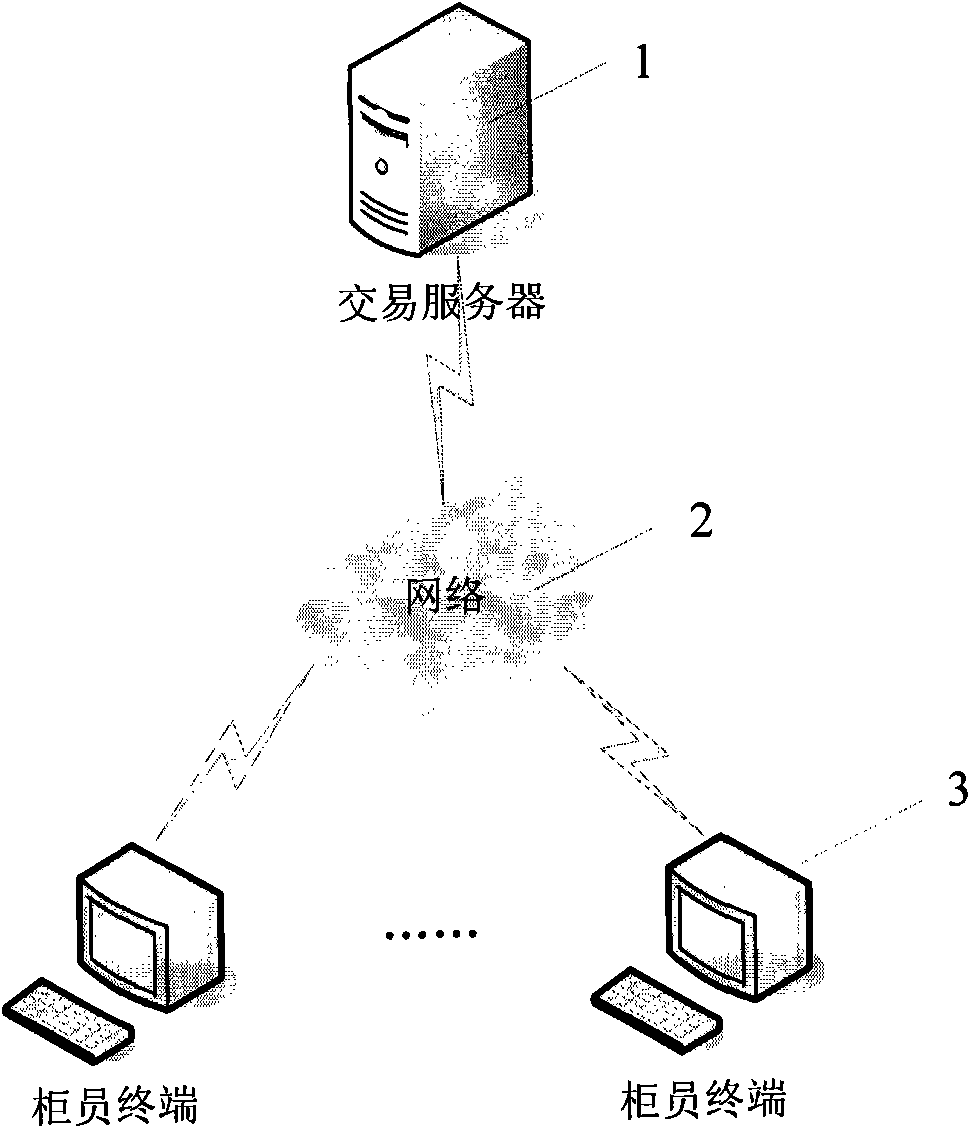

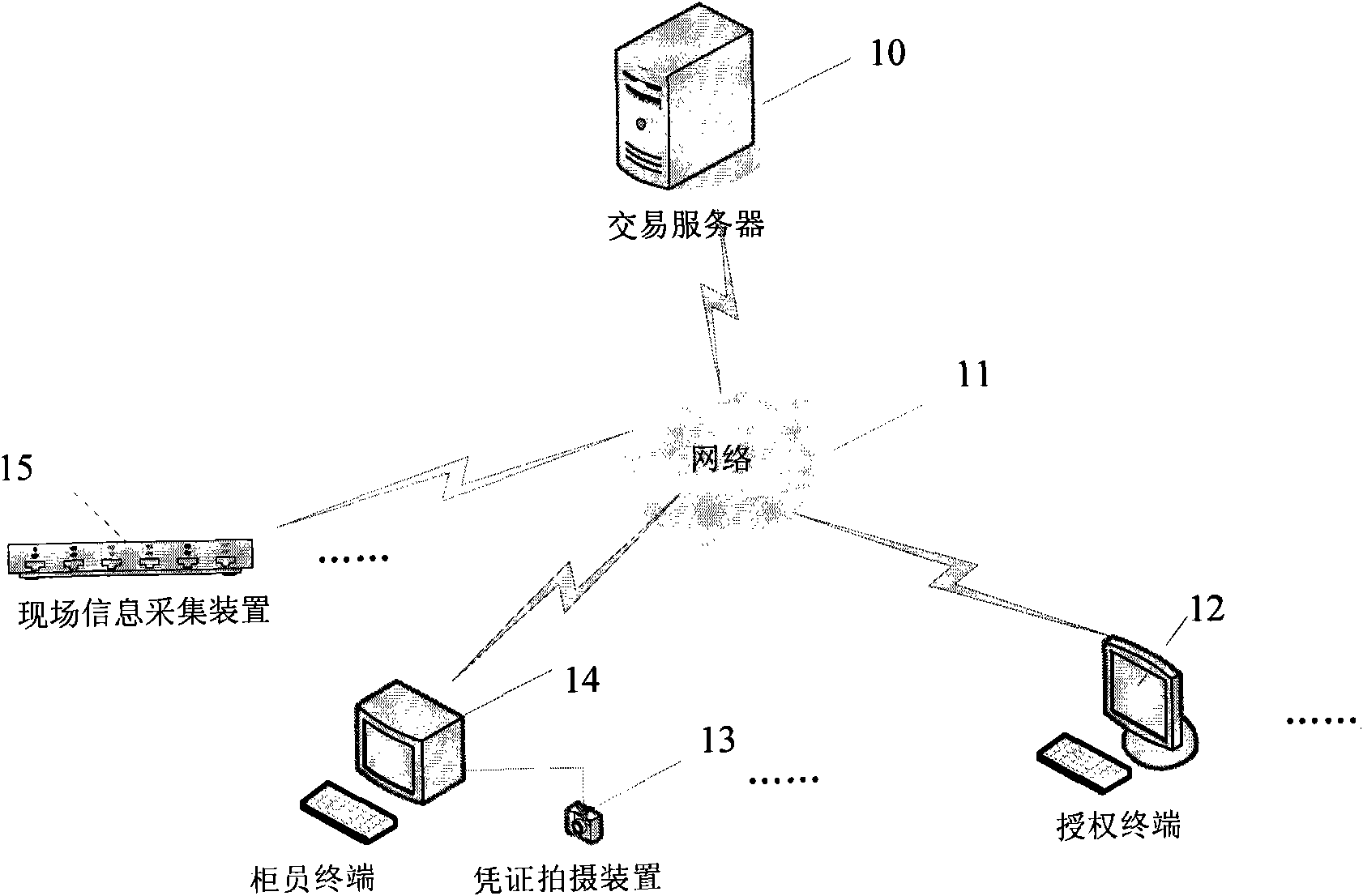

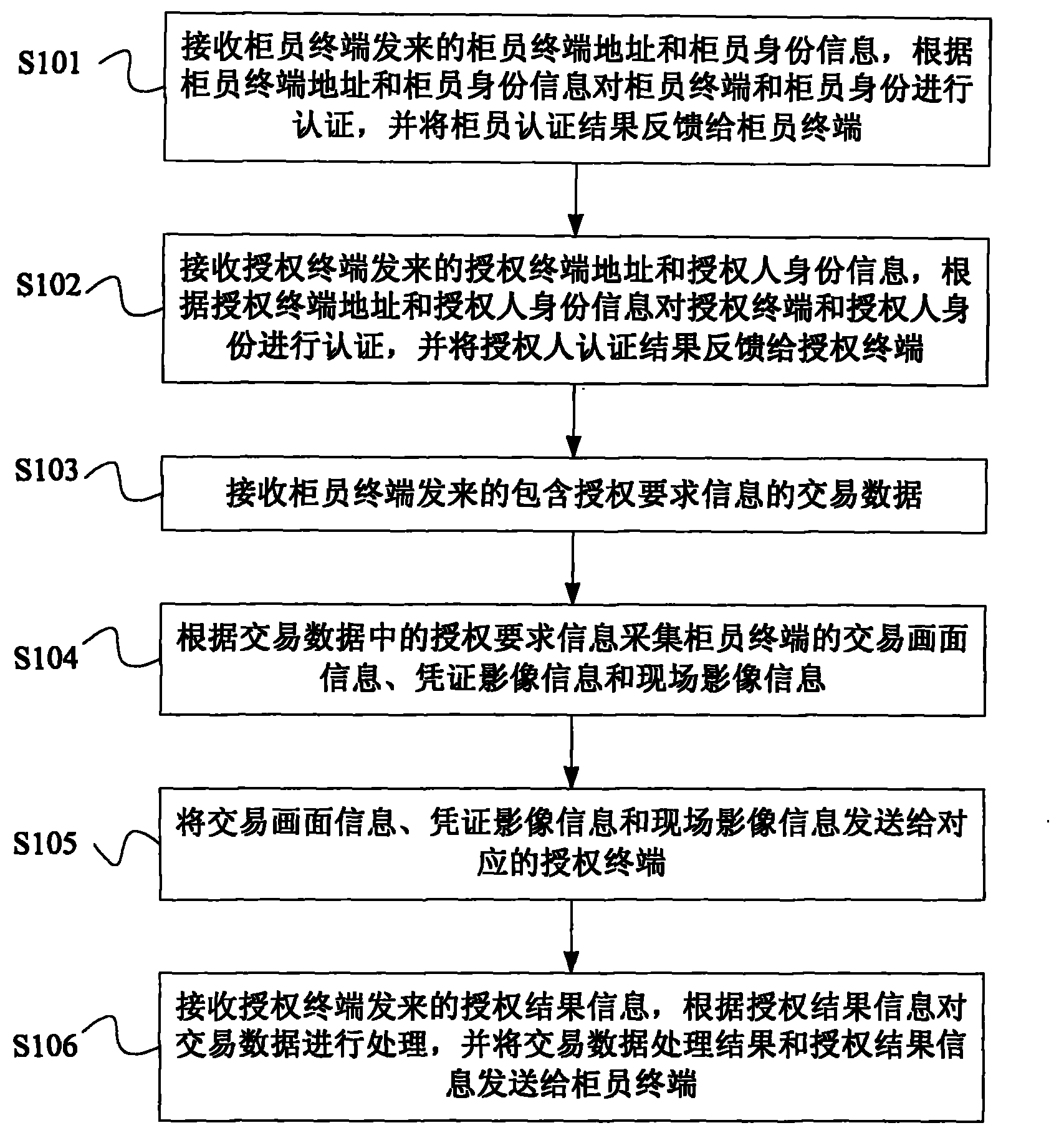

Bank teller terminal remote-authorization method, server and system

ActiveCN101916477AAddress the risks of centralized authorizationOvercome efficiencyComplete banking machinesClosed circuit television systemsBank tellerTransaction data

The invention provides a bank teller terminal remote-authorization system, which comprises a teller terminal, a voucher shooting unit, a field information shooting unit, a server and an authorization terminal. The authorization terminal acquires the transaction screen information, the voucher image information and the field image information, and shows the information to an authorized person through two or more displays. The voucher shooting unit is called by the teller terminal to acquire the image information of the voucher and transmit the image information to the teller terminal. The teller terminal connected with the voucher shooting unit is also connected with the server through the internet for receiving the transaction operation of a teller, transmitting the transaction information to the server, receiving instructions from the server, acquiring the information required for authorized transaction, and starting the voucher shooting unit to acquire the voucher information. The field information shooting unit receives instructions from the server or the authorization terminal and acquires the image information of the transaction field. The system solves the problem of remote authorization of counter services of financial enterprises, such as banks and the like.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

System and method for back office processing of banking transactions using electronic files

InactiveUS20060080255A1Reduce equipmentReduce laborComplete banking machinesFinanceBank tellerRelevant information

As banking transactions are processed by a bank teller, all of the relevant information with respect to the transaction (e.g., dollar amount) is captured in an electronic file. Each of the electronic files from the various branches of the bank are forwarded to a central back office processing center where the electronic files are combined into a single Transaction Repository. At the end of the branch day, all of the paper associated with the transactions is forwarded from the branches to the back office processing center. The paper transactions are imaged in the conventional manner and the Magnetic Ink Character Recognition (MICR) data is read from the paper. The present invention then automatically correlates the images and MICR data captured from the paper with the complete transaction record contained in the Transaction Repository. Most of the conventional back office processing can now be performed without the need to perform character recognition and without the need for excess human intervention.

Owner:JPMORGAN CHASE BANK NA

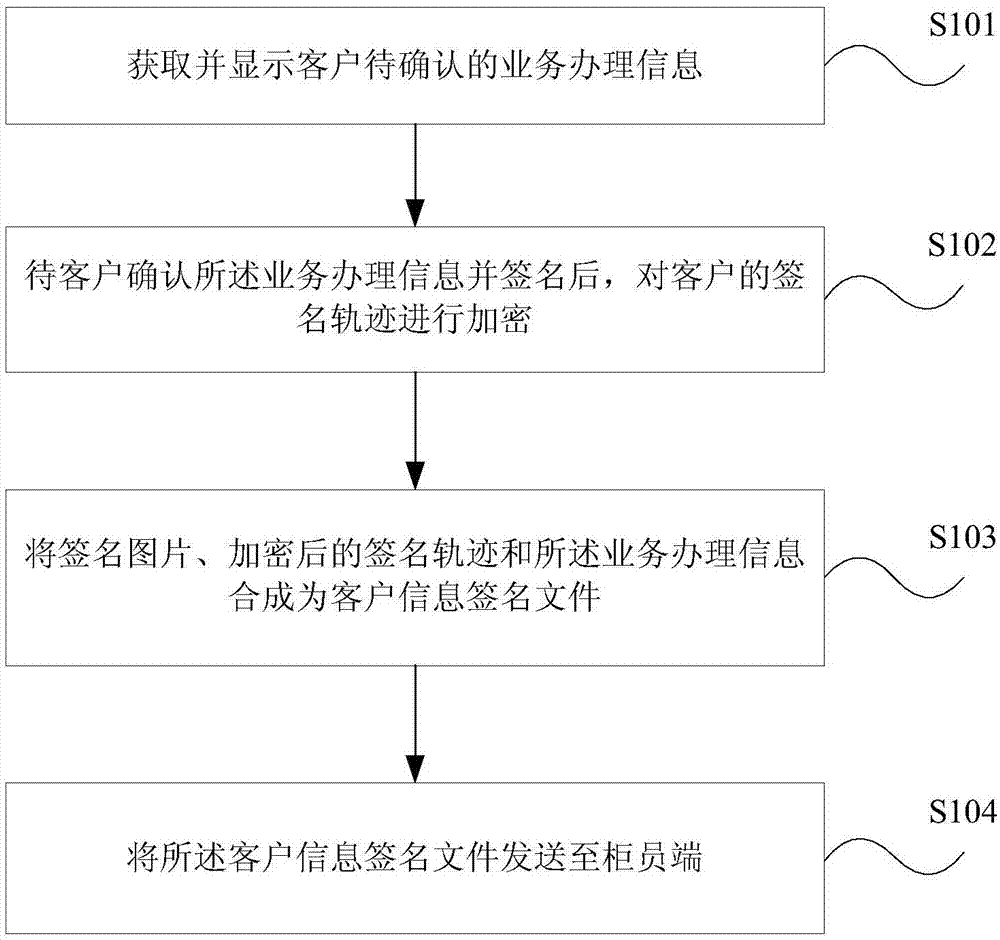

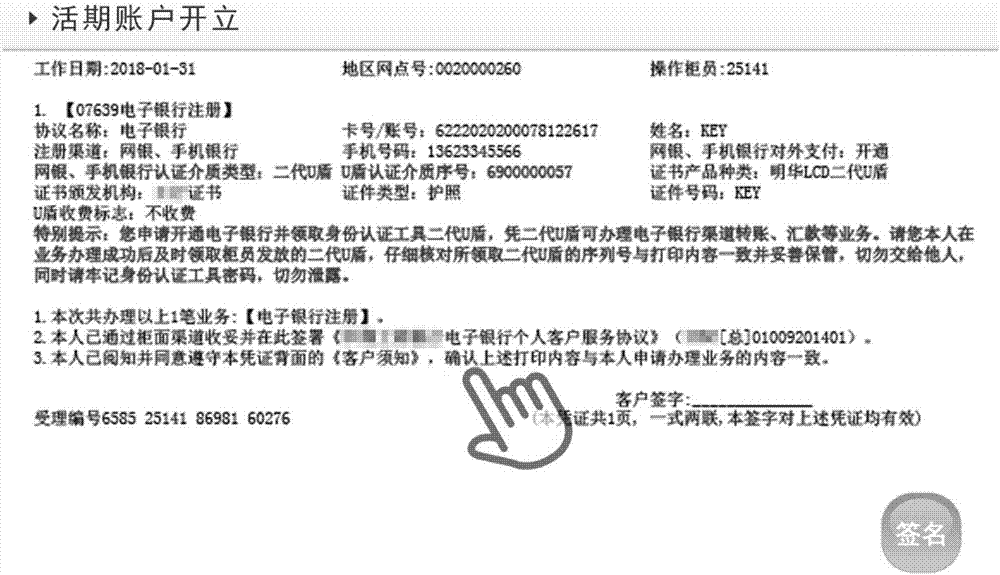

Counter information processing method and terminal and business handling system

PendingCN107316381ARealize electronicImprove service experienceComplete banking machinesCredit registering devices actuationInformation processingBank teller

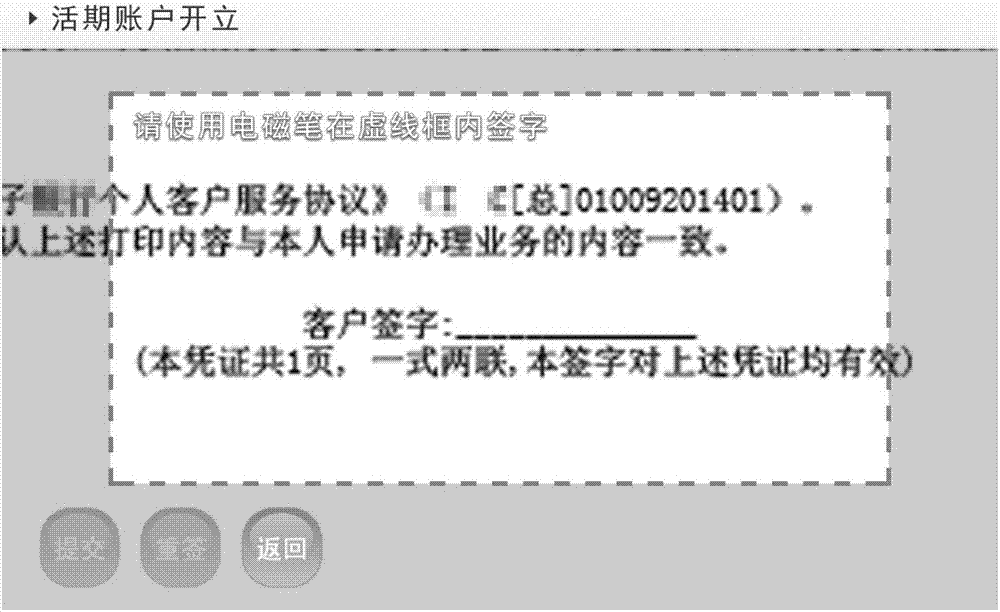

The invention relates to the field of bank business processing and provides a counter information processing method and terminal and a business handling system. The counter information processing method includes the steps that business handling information to be confirmed by a client is acquired and displayed; after the client confirms the business handling information and signs, a signature track of the client is encrypted; a signature picture, the encrypted signature track and the business handling information are synthesized into a client information signature file; the client information signature file is sent to a bank teller side. It can be achieved that business application and processing results are synchronously displayed to the client, the client is guided to participate in business processing through voice and characters, the business handling result is confirmed through an electronic handwritten signature, the terminal is used for completing U shield handover, transparency and electronization of the whole business handling process are achieved, therefore, the client service experience is improved, the counter processing efficiency is improved, the product marketing effect is promoted, the bank operating cost is reduced, operating risk prevention and control are enhanced, counter hardware facilities are integrated, and branch operating environments are beautified.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

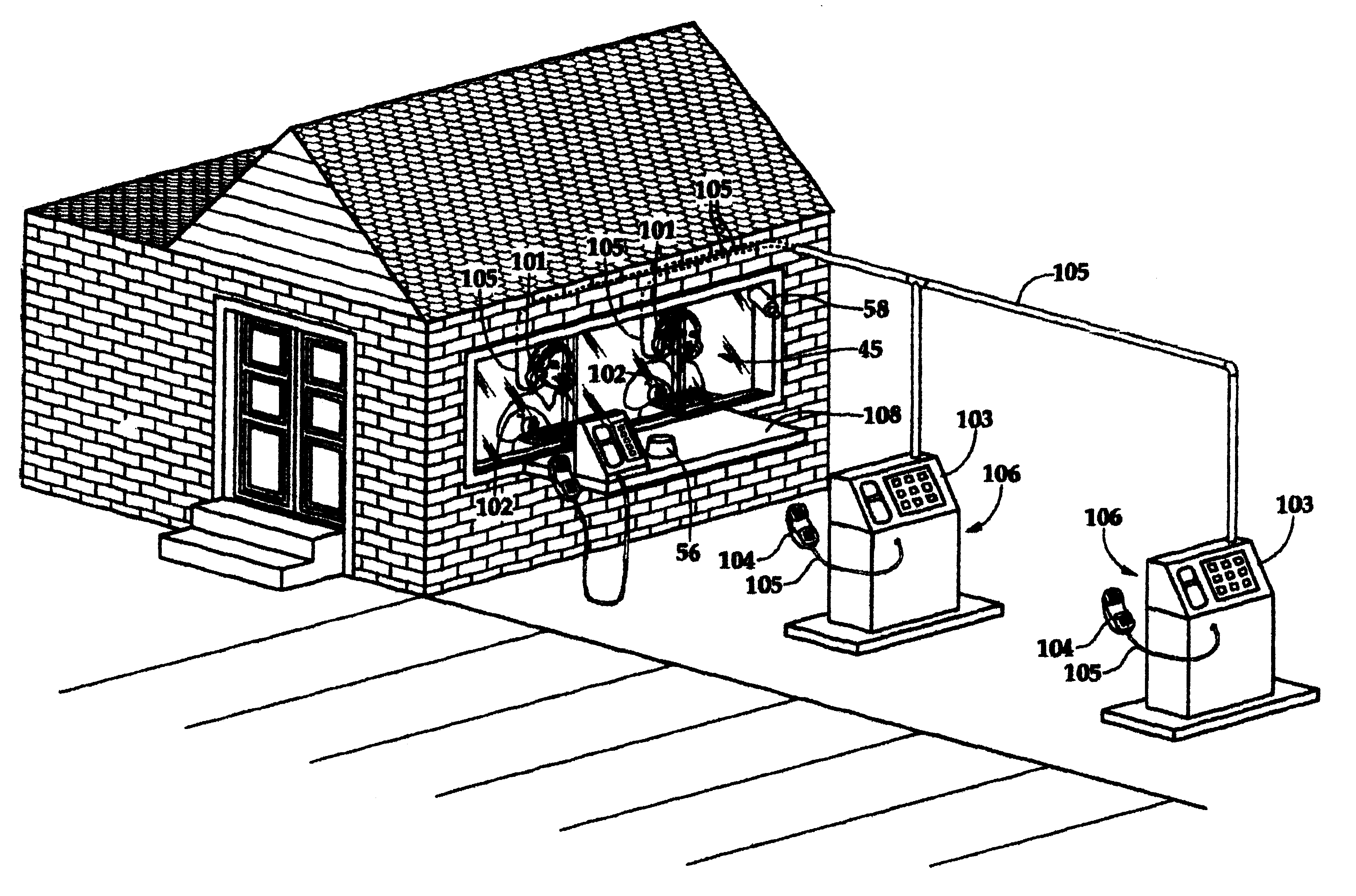

Lobby banking financial security transaction chamber

InactiveUS6655302B1Improve security levelLip reading of customer's financial transaction is also eliminatedComplete banking machinesSafety transaction partitionBank tellerFinancial security

A primary communication channel for drive-in customers performing financial transactions with bank teller while customers are in their cars from the drive-through lanes. This telecommunication system is a conduit secured line telephone receiver for each separate lane and is interconnected with corresponding headsets. The total design prevents cross-talk, amplified overhead conversations to other customers in their cars or to persons walking perimeter of drive-through banking areas. Each customer is provided with a complete primary communication channel for financial transactions Preventions of customers being identified as potential victims of financial exploitations through car tag associations with amplified conversations. Improved apprehension of person attempting to rob bank from bank teller's transaction window of drive-in area.

Owner:ROSS JUANDE

Bank service form pre-filling method and system

The invention discloses a bank service form pre-filling method and system. Firstly, a reservation request is transmitted; secondly, a client form corresponding to the reservation request is filled in a matched manner according to pre-stored user information and fulfilled to obtain a final form filling result. On one hand, a user is allowed to freely fill the form through mobile phone application software in any places with networks and indirectly reminded of information needed in the form filling process. On the other hand, historical form filling data of each client can be recorded as corresponding user information, parts of form items of the client form are automatically filled by automatic filling when the client needs to fill the form, and time of the client is saved. When handling a service, a bank teller can take the form, the trouble of inputting information to the system is omitted, and bank working efficiency is greatly improved.

Owner:WEIRONG TECH CO LTD

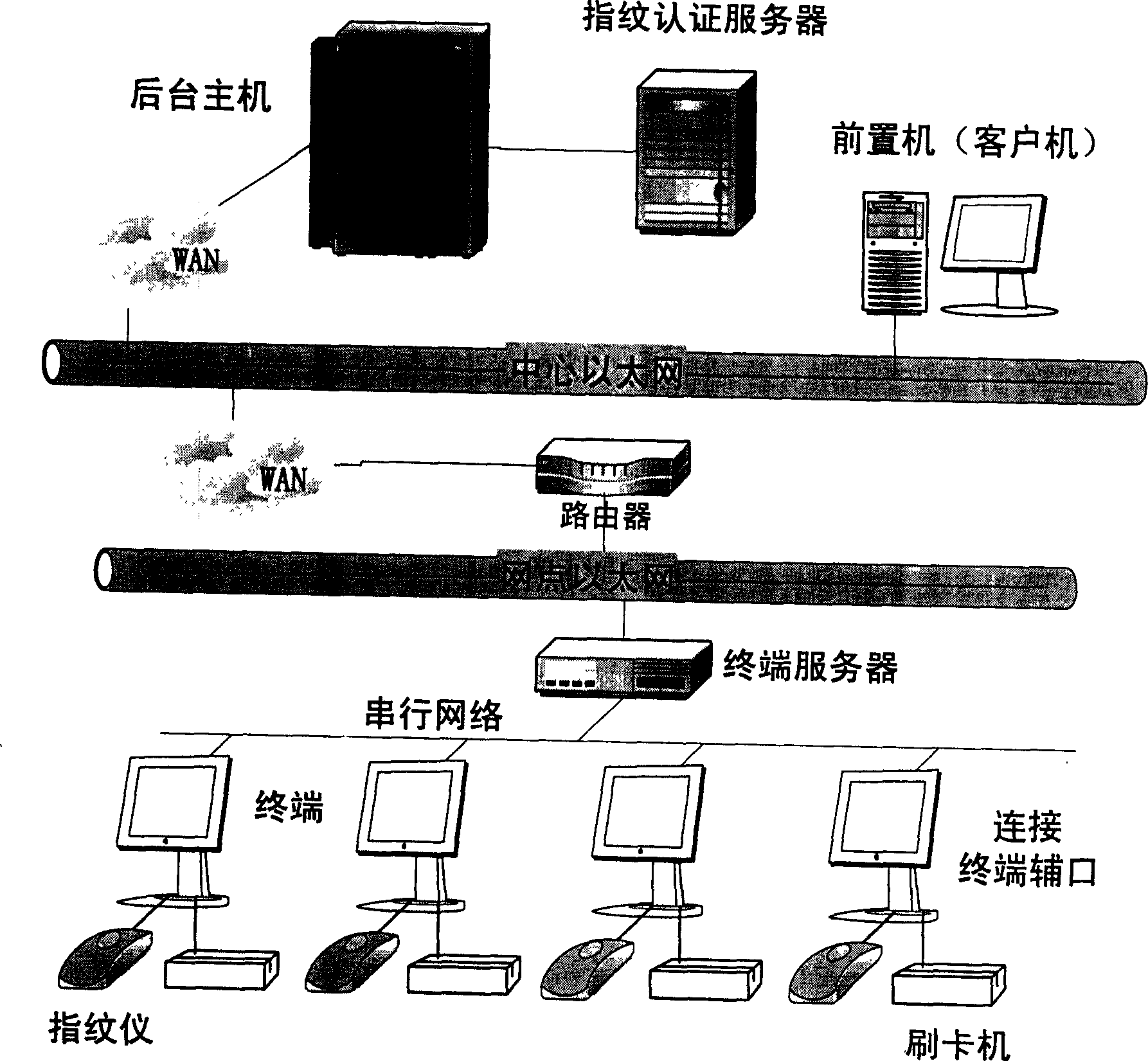

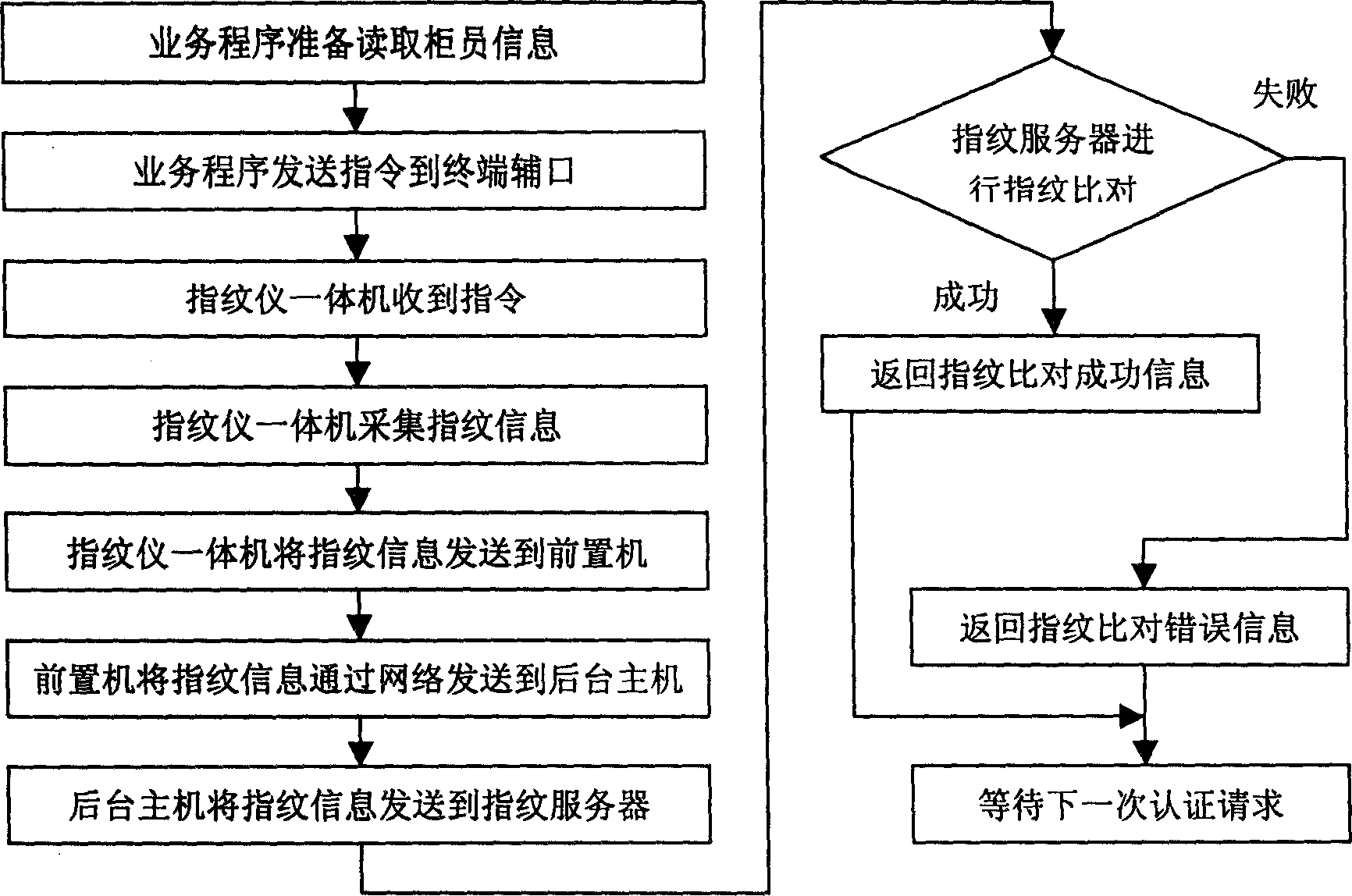

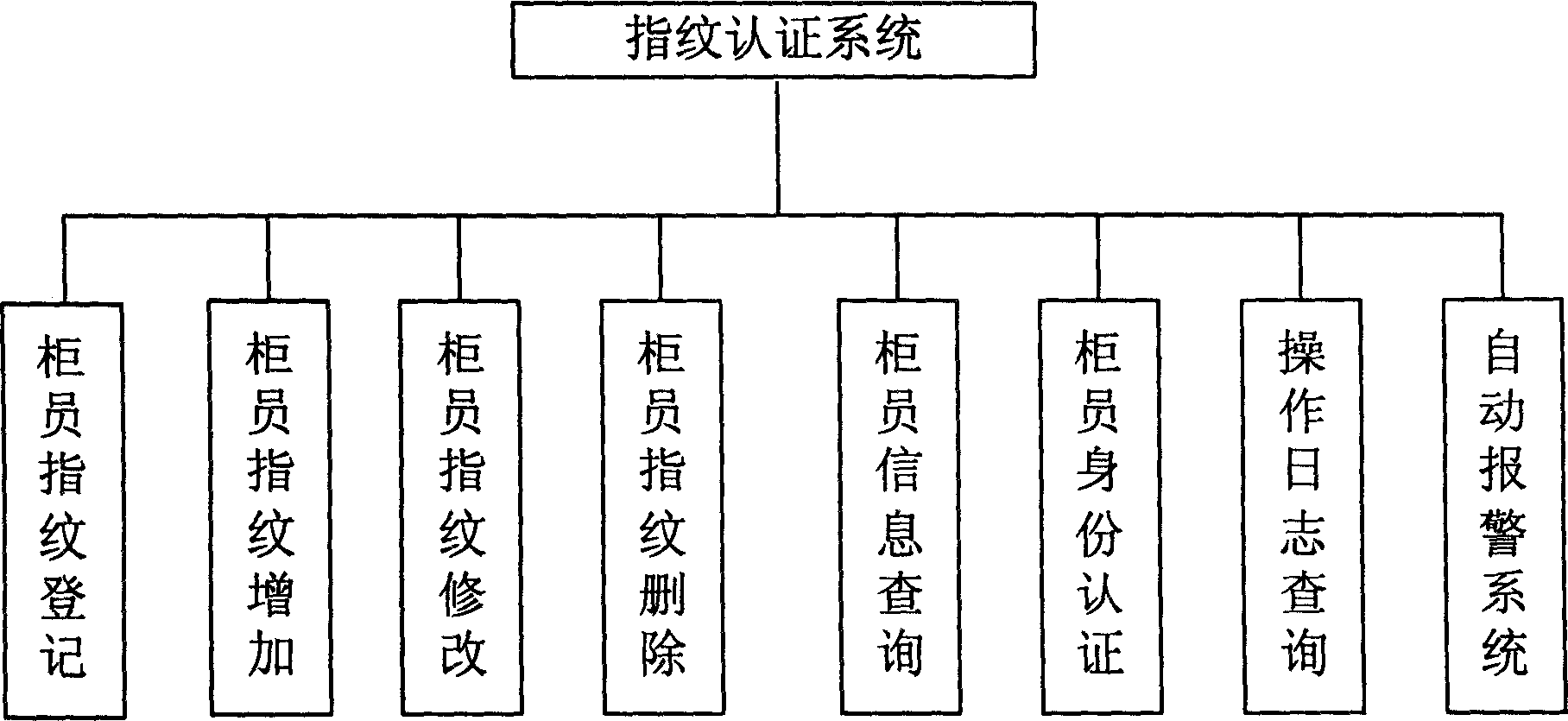

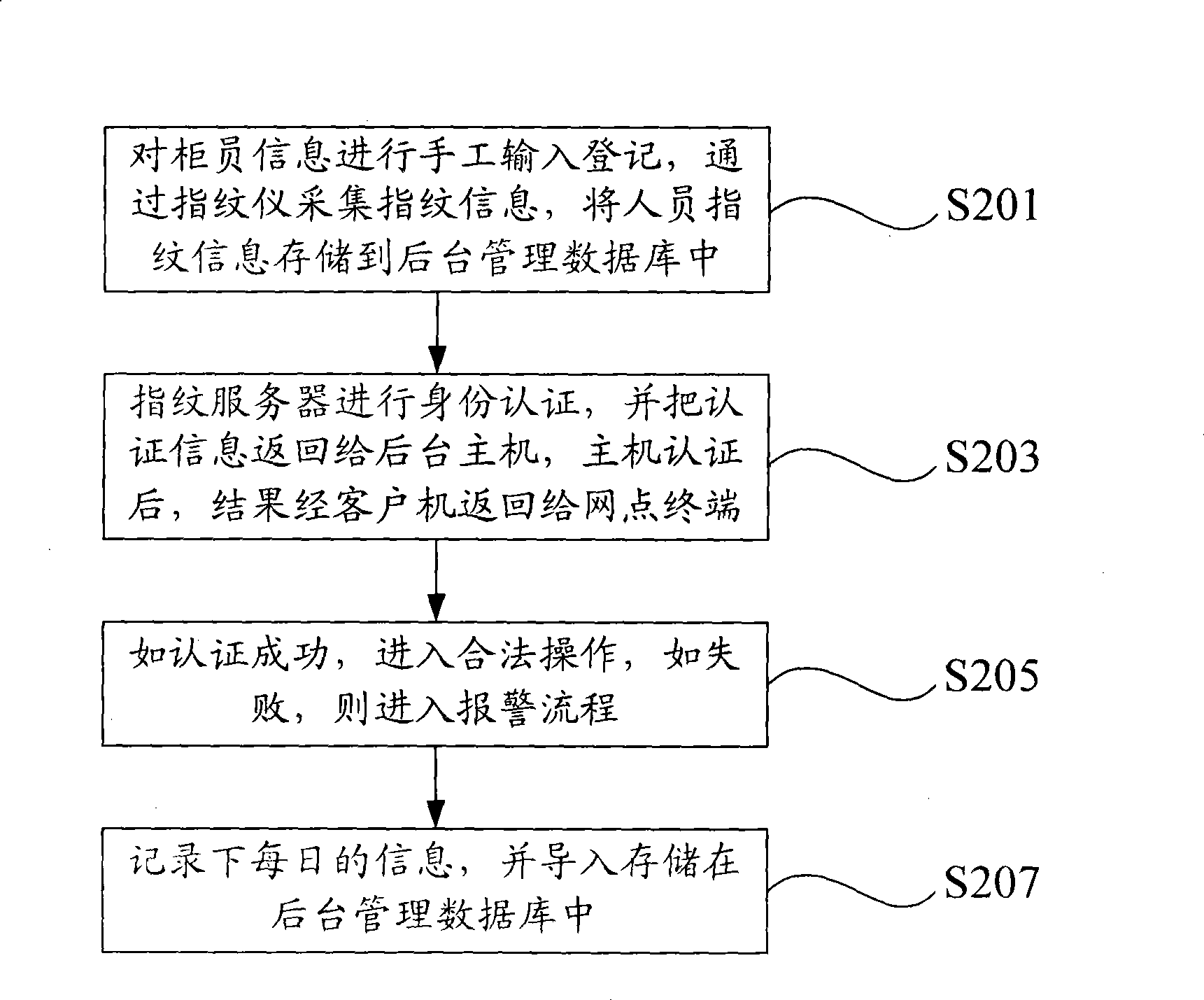

Method for using finger print identification technology in bank teller management

InactiveCN1492375AEasy to useEnsure safetyCharacter and pattern recognitionMultiple digital computer combinationsBank tellerComputer science

The method of using fingerprint identification technology in bank teller management includes the steps of: inputting manually the teller information, collecting fingerprint information via fingerprint instrument and storing the fingerprint information of the tellers in background management data base; during service operation, extracting the fingerprint information of the teller in the fingerprint scanner, sending via client computer to the background host computer, sending fingerprint confirming request by the background host computer to fingerprint server, confirming, and returning the confirming result to the net point terminal; entering legal operation after successful confirmation, or else entering alarm procedure; and recording daily information and leading to the back management data base. The present invention has the advantages of ensuring the safety of bank operating system.

Owner:陈杰

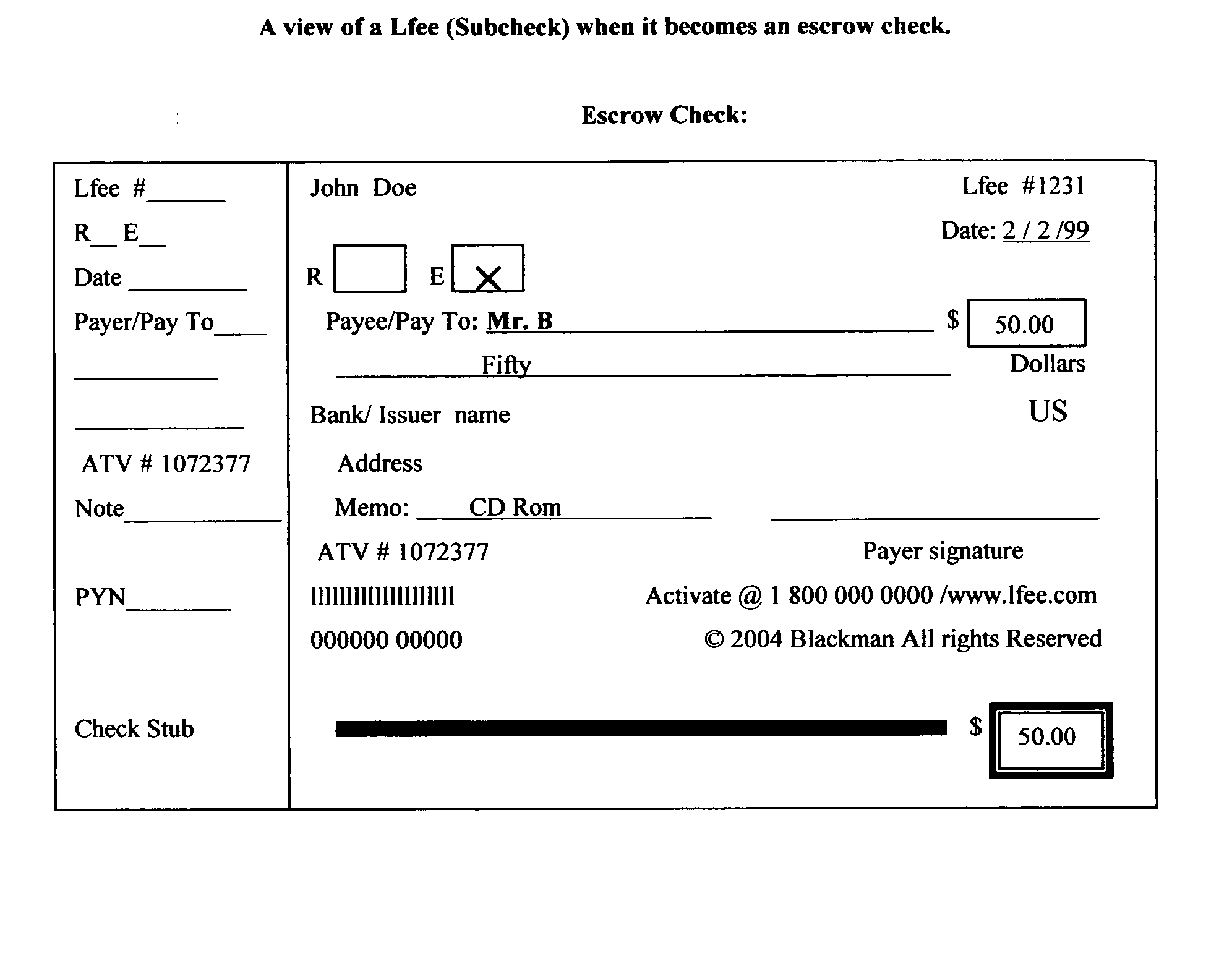

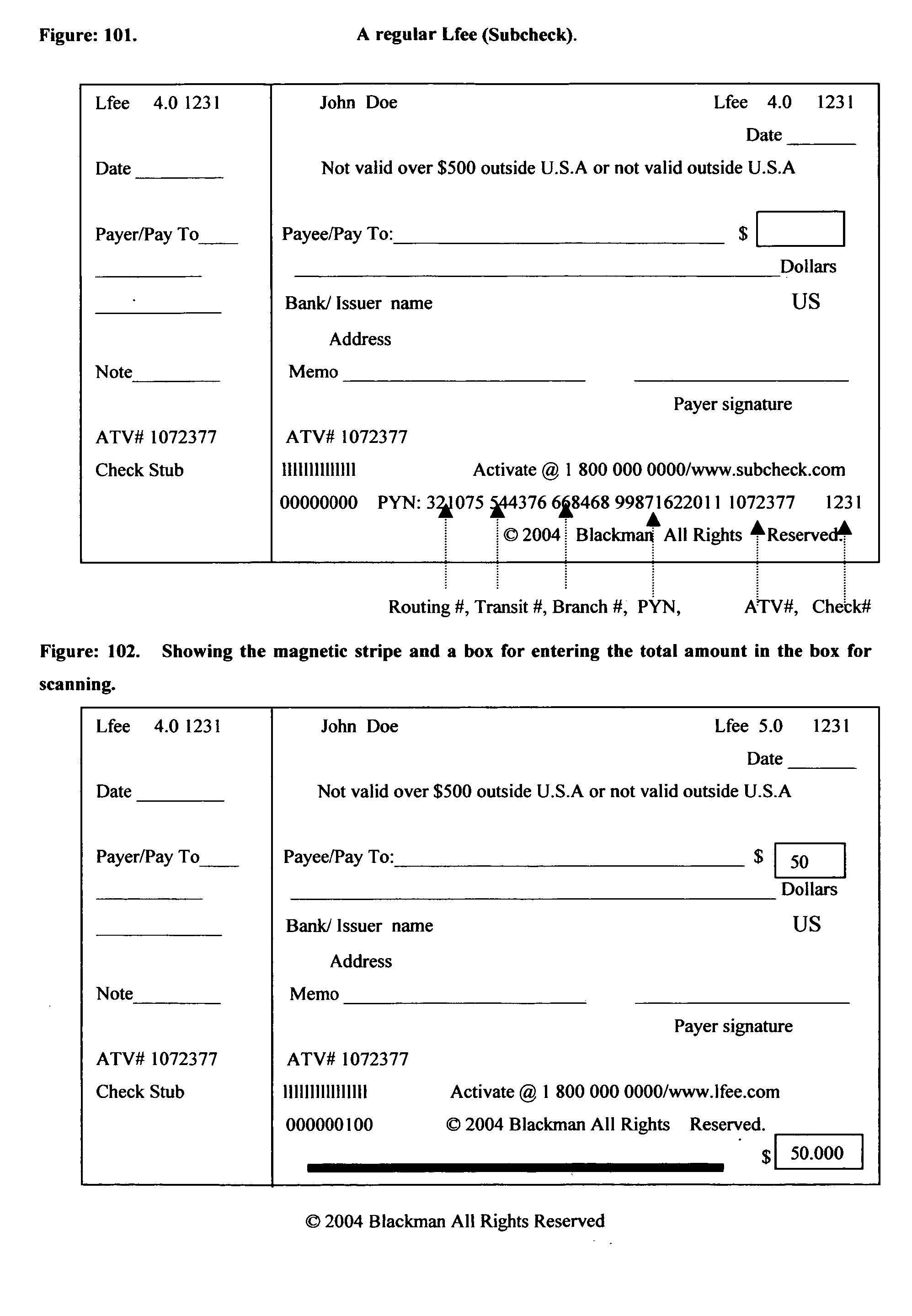

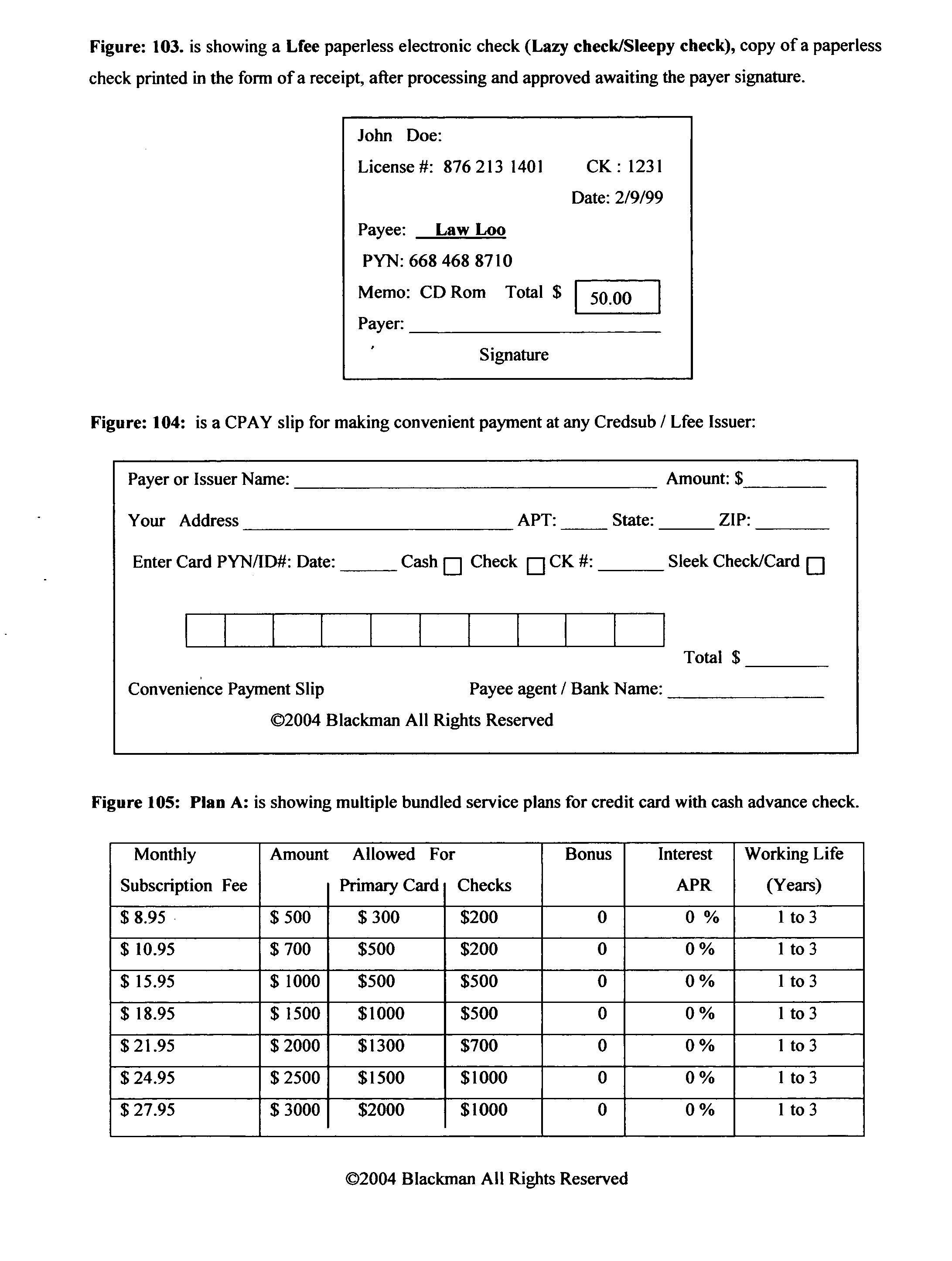

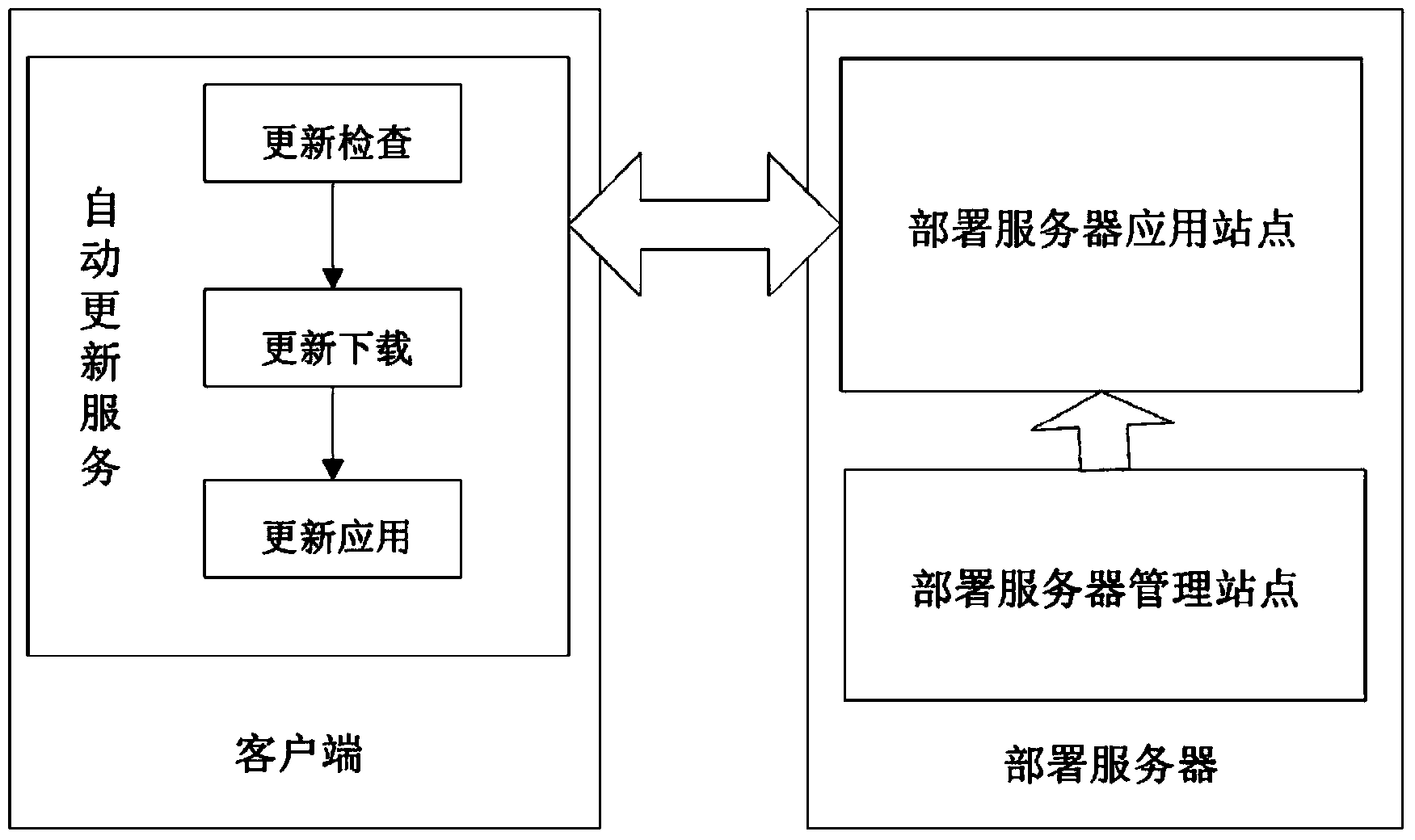

Credsub (credit subscribing) EEECI (easy economical enhancing credit innovation) or new economical enhancing credit innovation (NEECINN/NEECIN):

Subscribing Credit plans with unlimited and limited life with a Paperless electronic checking system, electronic checkbook, credit card system with a utility card carrying four digits, with disposable or static numbers, using a personal software dialer / connect to login to a web template for fraud-less transaction. Purchase and or lease Credit without interest or with interest at a fix or unfix APR renewable. Credit increase by purchasing higher plans. Payment on outstanding balance over $50 is 2%-5% minimum, balance $50 and under is 25%-50%. Security feature (Checkact) that lock and unlock checks or financial card. Escrow features certify checks and allowed the payee to deposit it without using a bank teller or entering the bank. PYN prevents payee and payer from seeing each other account number on the check. Account has no accruing interest on outstanding balance. C-pay allows payment through any, Credsub issuer.

Owner:BLACKMAN LEE

RFID tracking of chose in action

InactiveUS20080231445A1Increased durabilityEasy to identifyLogisticsElectric signalling detailsFiberBank teller

This invention assigns differing chose in action categories, such as banknote, check and stock certificate. Each category reflects electro magnetic signals through a nano size silicon integrated circuit package known as an RFID transponder. As an example, a unique identifier number, serial number, denomination amount, will be written onto each RFID transponder. A specific frequency can be assigned to each category. Each category is divided by at least 2 MHz with all transmissions taking place within the 24 to 40 GHz frequency range. The chose in action can be interrogated at specially shielded stations, such as cash registers or bank teller windows or at stock brokerage firms, to verify the authenticity of the chose in action. The interrogators will be connected to a centralized host system comprised of computer server and middleware to trace and track the progress of the chose in action through the economy in real time. This invention contemplates embedding the RFID nano size silicon integrated circuit package into polymer or paper based chose in action using a laminate or fiber weaving process.

Owner:RODGERS JAMES NEIL

Radix algorithm encryption method for dynamic password

The invention discloses a basic operation encryption algorithm which is the discovery in the mathematics field and the application in the encryption field. And it is easy to be learned and spread. The invention can utilizes the variable false code (dynamic code) to solve the problem that the hacker can filch the code with the software as wooden horse. The server transmits the auxiliary code which has same number of bit with the user code to the client end, and the client utilizes the basic operation encryption algorithm to process the basic operation on the real code (stable code) and the auxiliary code, to attain the dynamic code as the false code which will be fed back to the server to be validated. Since each time the random auxiliary code is different, the dynamic code input by client is different, the invention can effectively prevent filching code. In addition, said basic operation encryption algorithm can apply the online bank, bank teller machine, POS, stock deals system, e-main system, online game, electronic business and communication.

Owner:王松

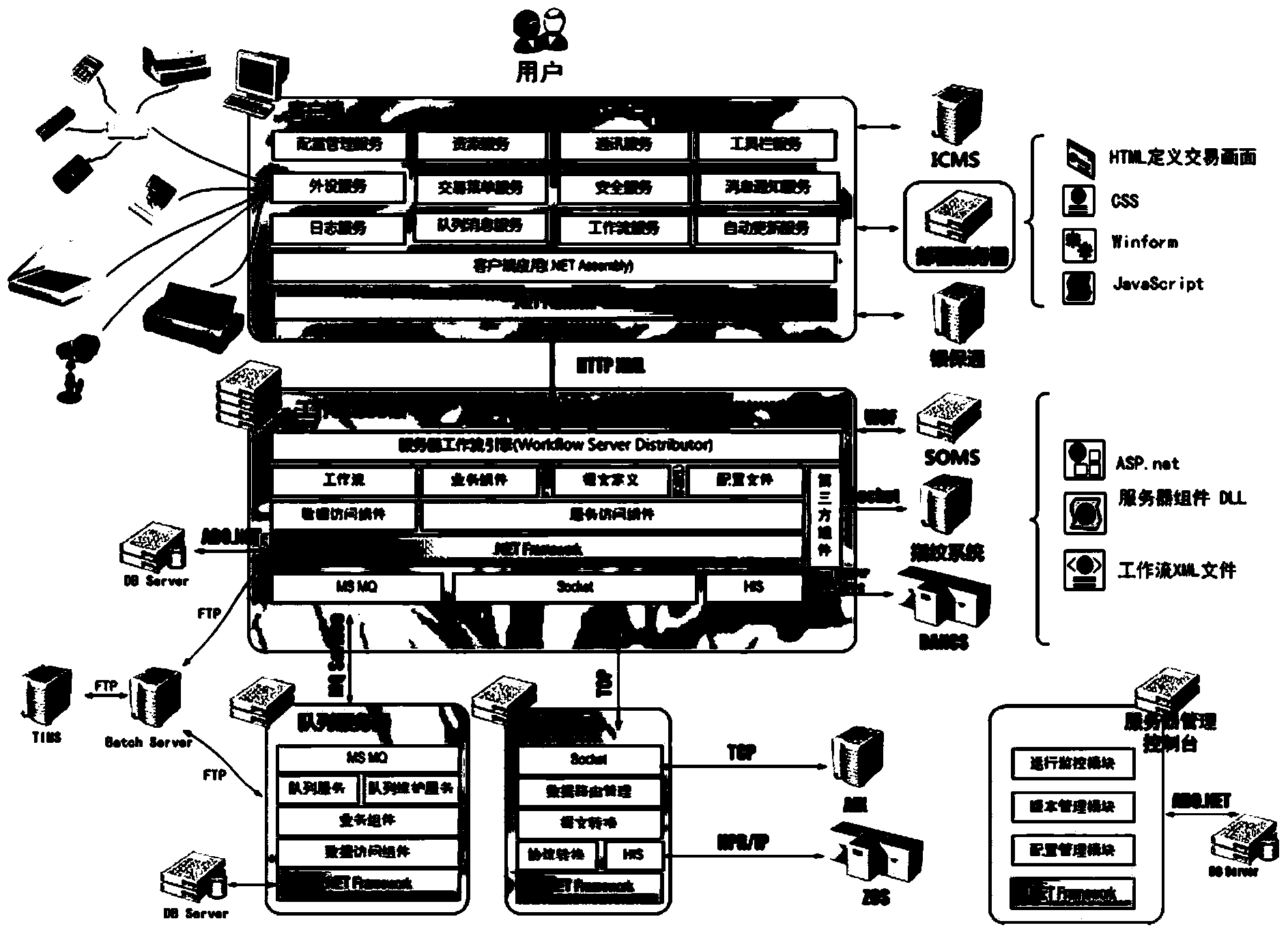

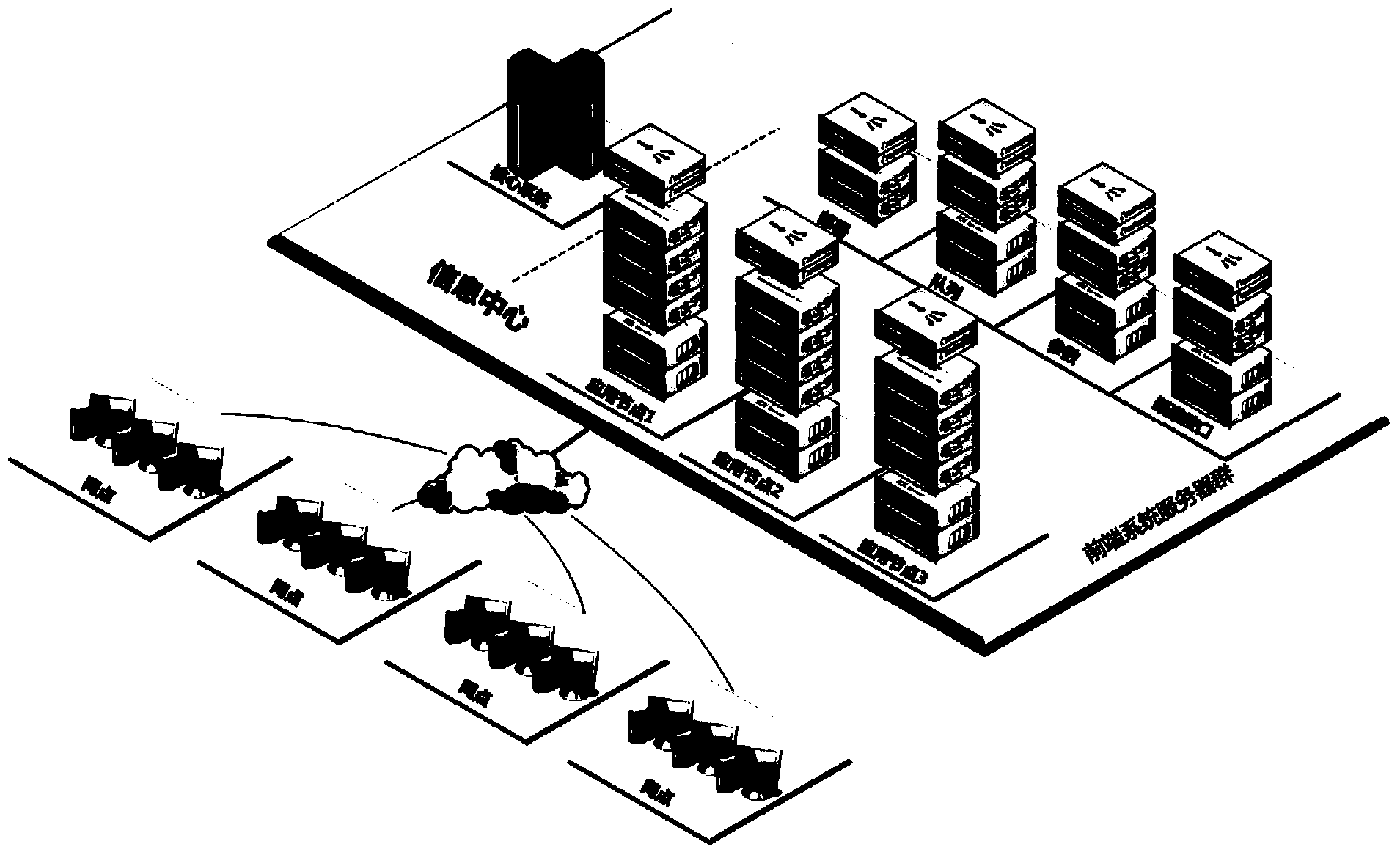

Bank teller front-end system

InactiveCN104320482ASatisfy business functionsSatisfy securityFinanceTransmissionBank tellerSafety control

Owner:BANK OF CHINA

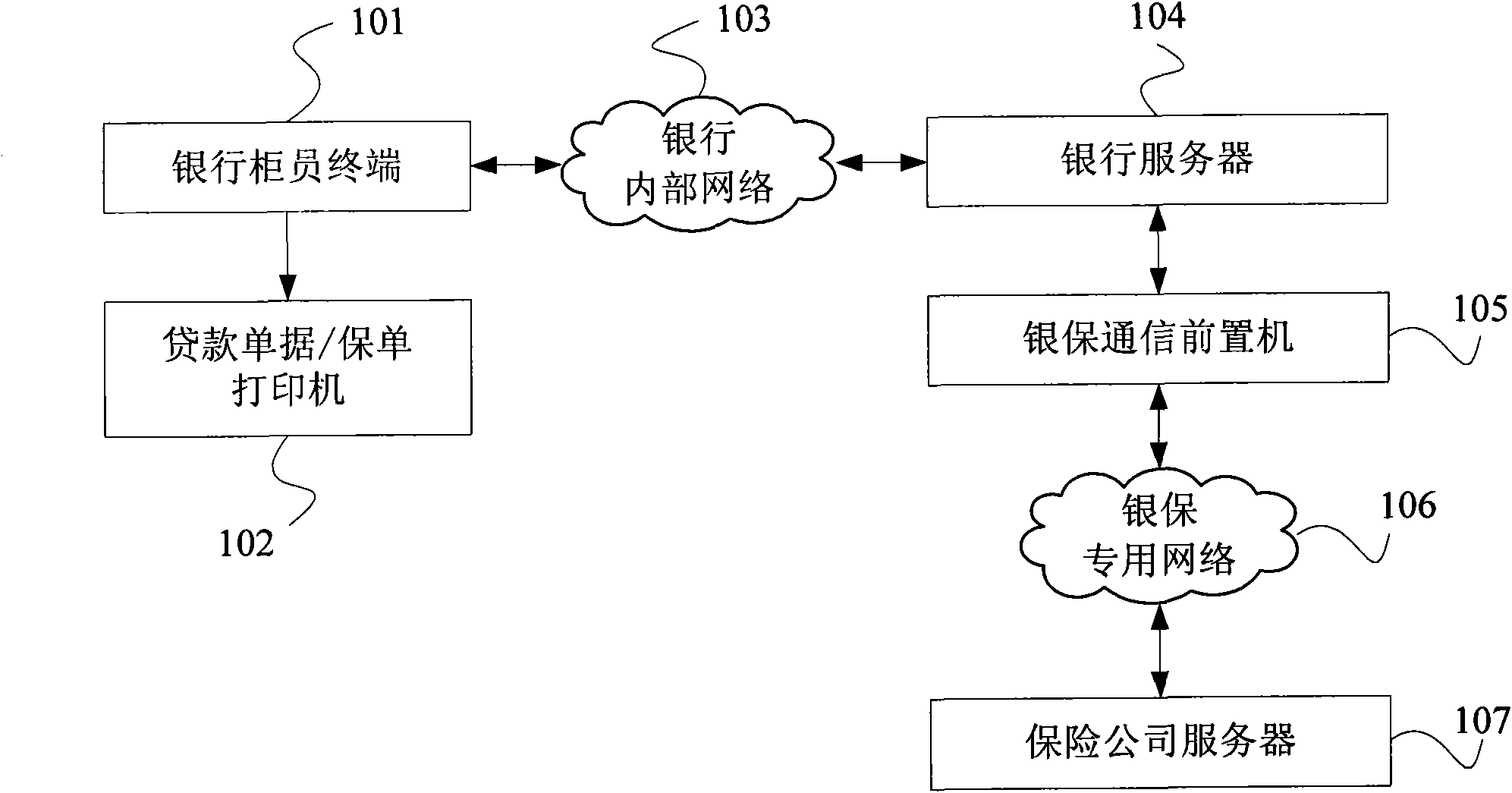

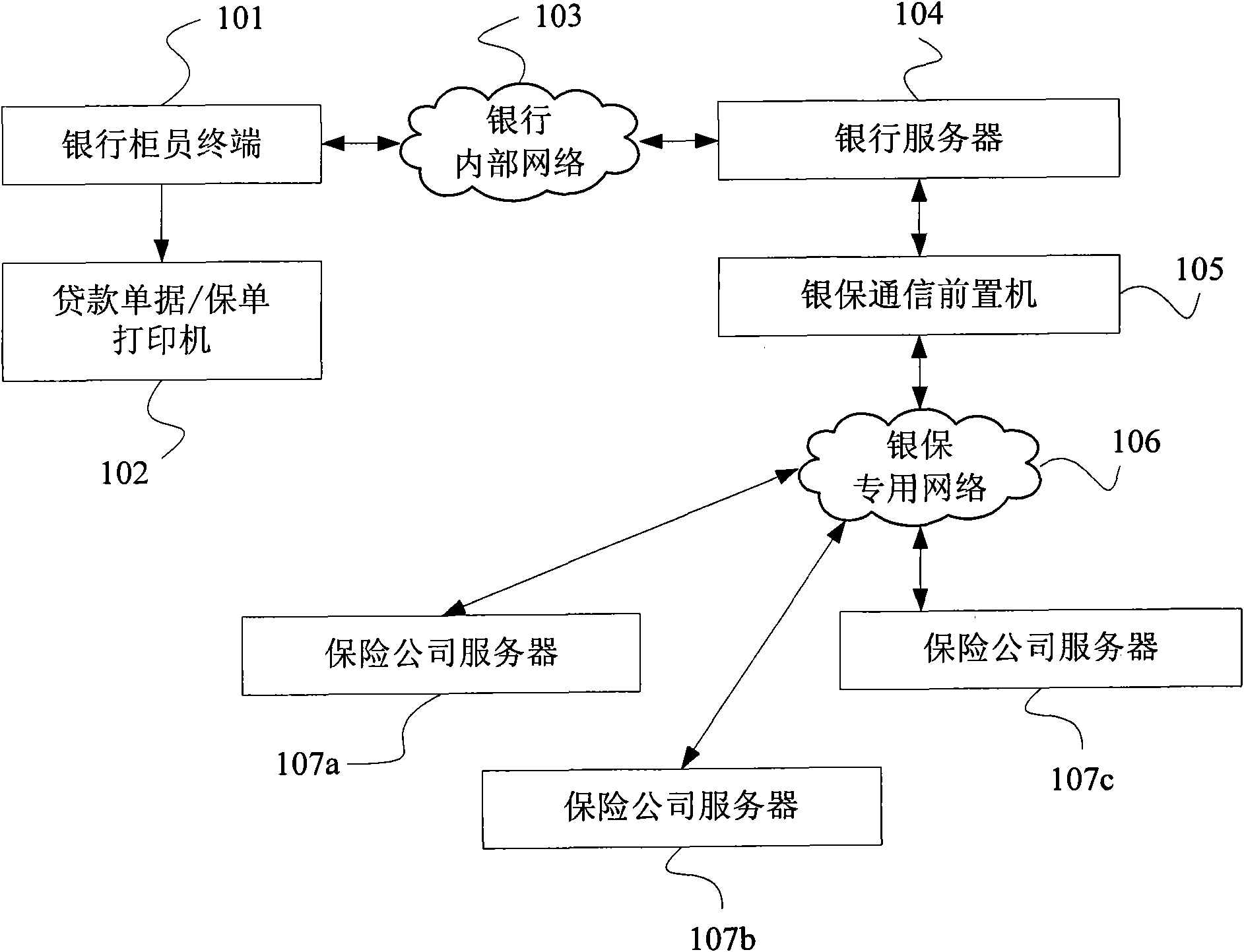

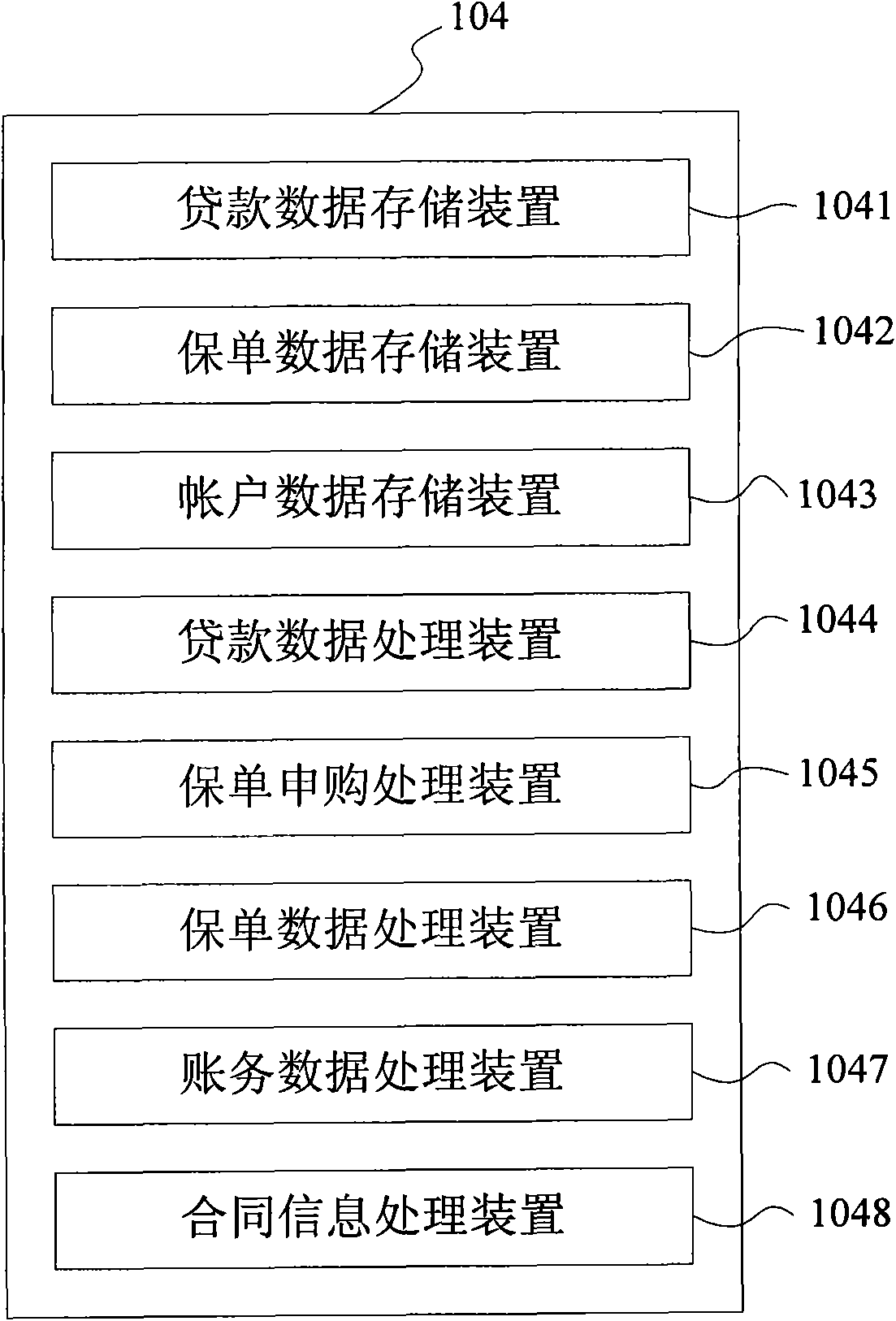

Insurance policy output device based on bank teller terminal

The invention provides an insurance policy output device based on a bank teller terminal. The device comprises the bank teller terminal, a bank server, a communication front-end processor and an insurance company server. The communication front-end processor comprises a first data format conversion device, a second data format conversion device and a network communication device, wherein the first data format conversion device is used for converting banking system format data into insurance company system format data; the second data format conversion device is used for converting the insurance company system format data into the banking system format data; and the network communication device is used for transmitting the banking system format data transmitted from the bank server to the first data format conversion device, transmitting the insurance company system format data transmitted from the insurance company server to the second data format conversion device, transmitting the insurance company system format data converted by the first data format conversion device to the insurance company server, and transmitting the banking system format data converted by the second data format conversion device to the bank server. The problem that banks and other financial systems directly process insurance service data is solved.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

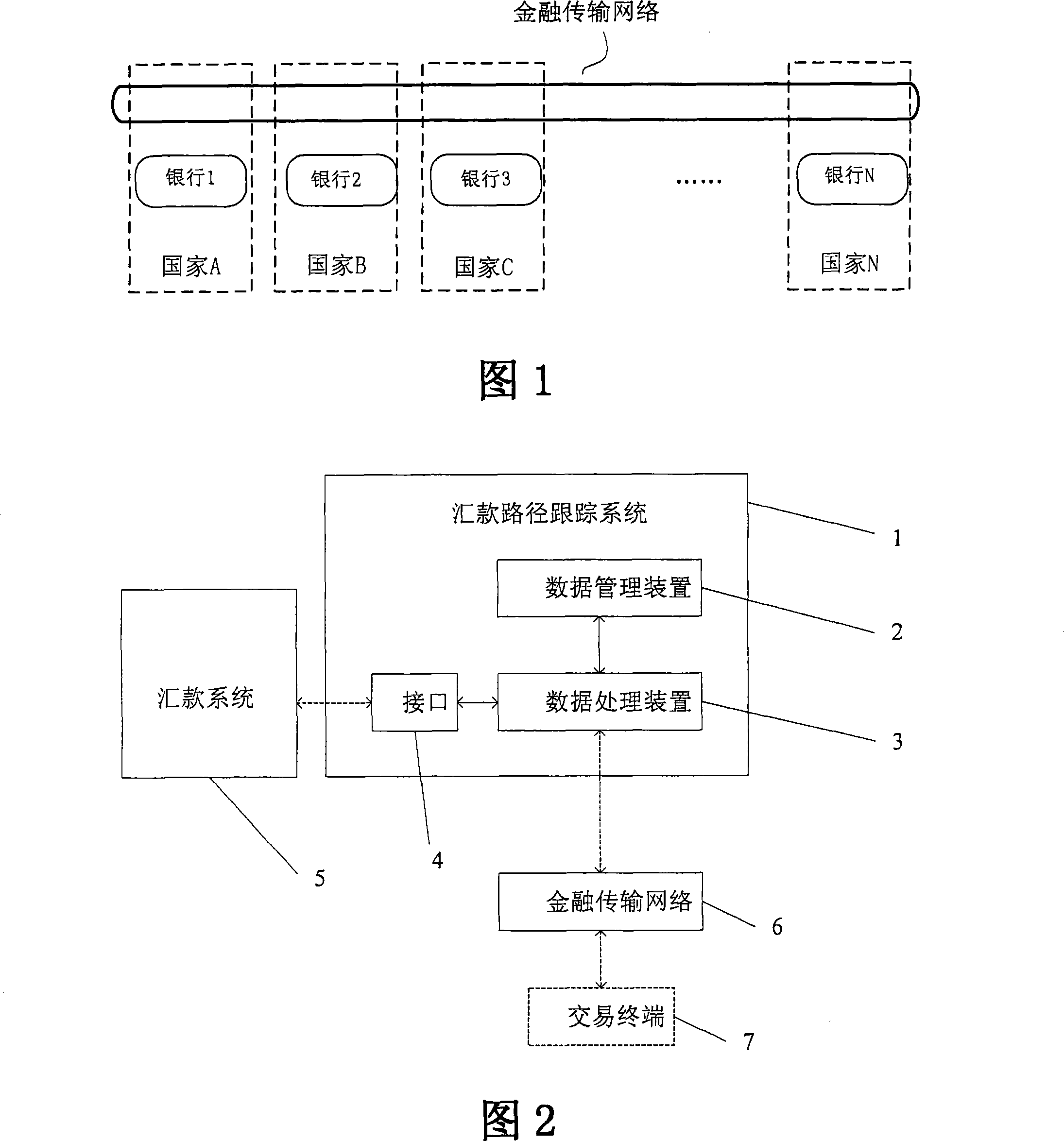

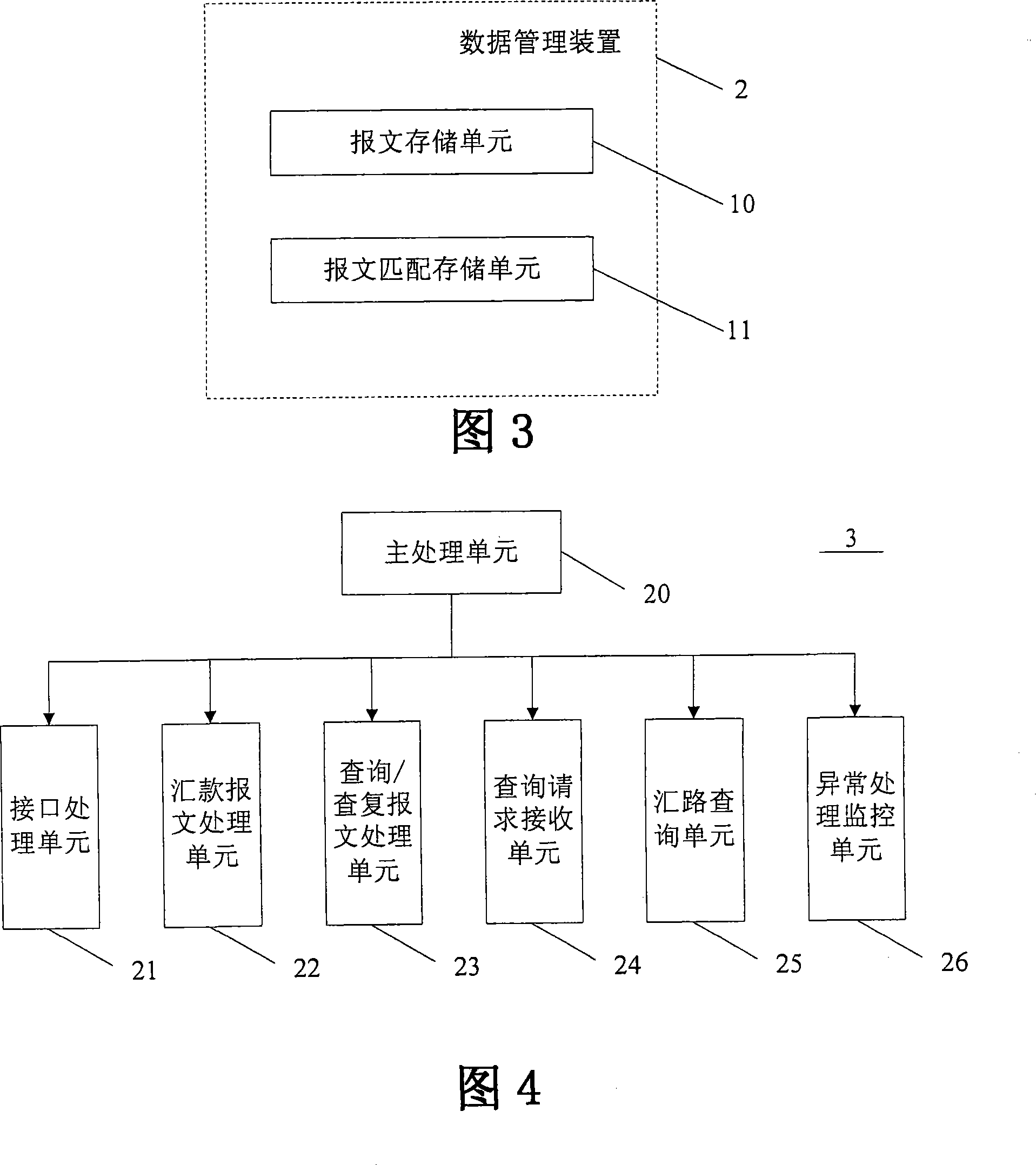

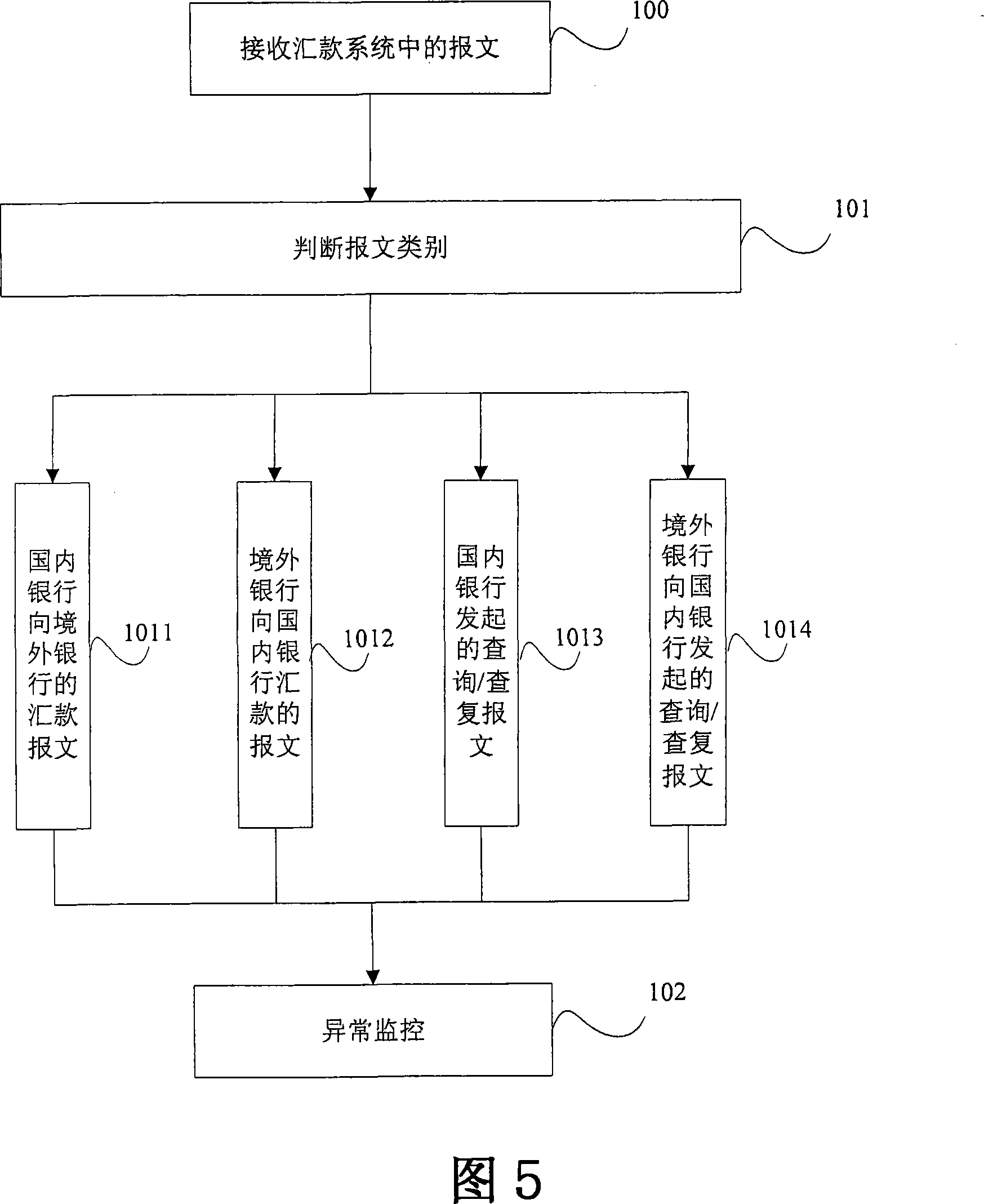

Remittance path following system and method

The present invention provides a remittance path follow system and a method for solving the problem that client can not obtain real-time state of remittance in existing technology. The method includes steps: relative remittance report is obtained from existing remittance system, said remittance report is stored in data management device, said relative remittance report information is updated along with processing for said remittance report by said remittance system; then query report is received, the relative remittance report state information according with client query condition is returned to client by querying relative remittance report date of said data management device. The invention has benefits in that bank teller and client can query newest process state and path information of a remittance at any time so as to give corresponding process.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

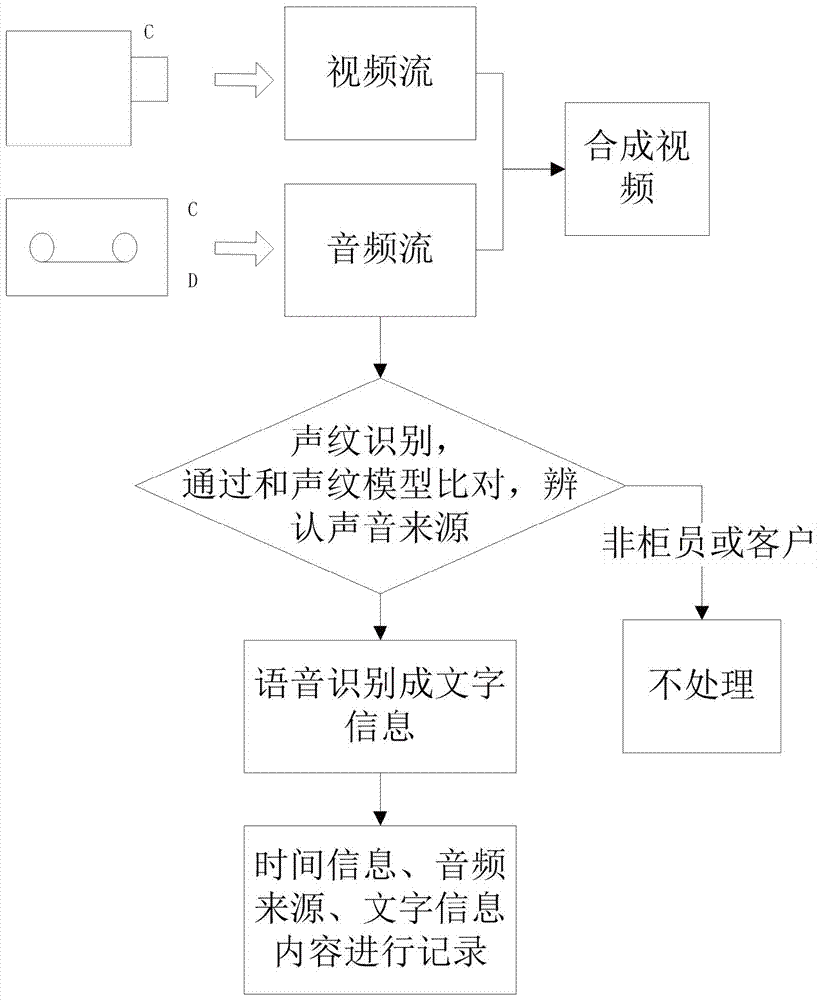

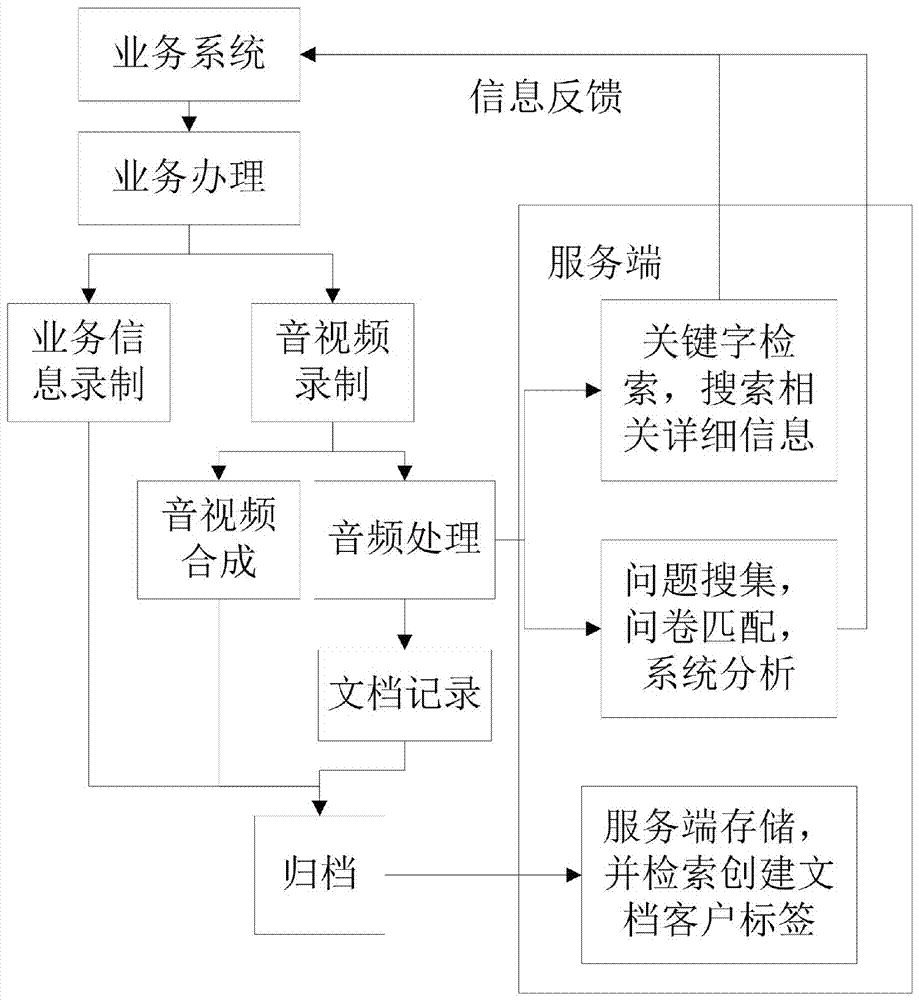

Voice expansion application method based on financial management double recording system

InactiveCN107038582AQuick understandingMaster investment abilityTelevision system detailsColor television detailsTime informationSound sources

The invention provides a voice expansion application method based on a financial management double recording system. The method comprises steps of the acquired audio is transformed into the text information by the speech recognition technology, the sound source is identified by the voiceprint recognition mode, and the time information is added and recorded; the keyword in the text information is timely searched in the financial business transaction for the obtained text information, and then is sent to the background for retrieving and is actively pushed to the bank teller interface, meanwhile, some special problems are set, the answers of the client are sent to the background, the background system performs behavior analysis of the client investment capacity and investment intension, the contents of the conversation is documented, and the keyword is searched as the file label and the client label. The expansion treatment of voice in the double records enables the double recording equipment to be fully utilized. The client information is obtained by voiceprint identification and voice identification, and is sent to the background for further analysis and processing to help the bank teller to timely obtain the detailed information in business transaction.

Owner:FUJIAN CENTM INFORMATION

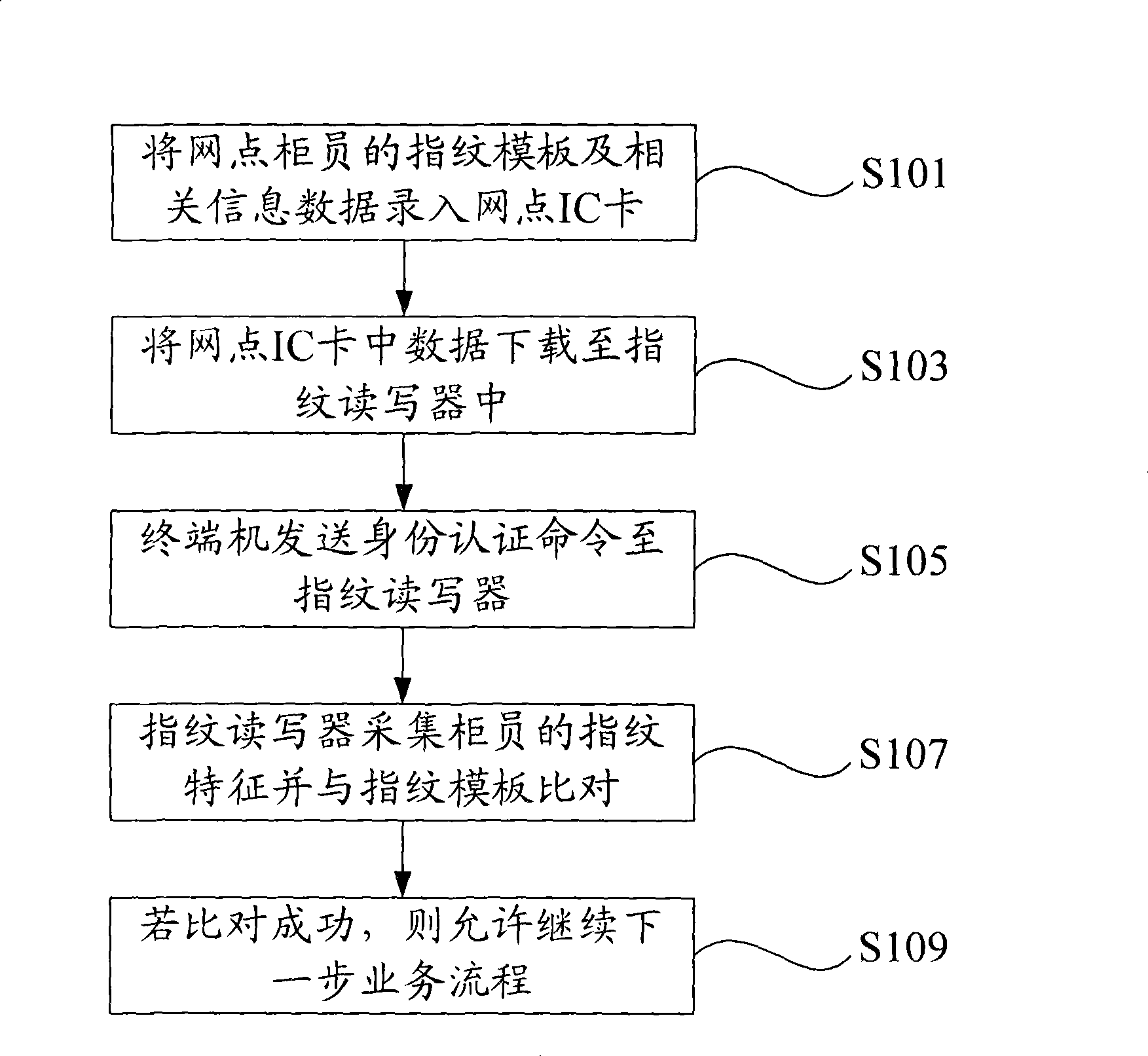

Counter employee identity authentication system and method

ActiveCN101488256AAvoid the Dangers of Replay AttacksAvoid the dangers of hacking authentication systemsComplete banking machinesUser identity/authority verificationThird partyReal-time clock

The invention discloses a teller ID verifying system which comprises a plurality of bank websites and a central machine room. Each bank website comprises a plurality of teller terminals, a plurality of fingerprint instruments and a front end processor. The fingerprint instruments are corresponding to the teller terminals one by one; and each fingerprint instrument is connected with one teller terminal. Each fingerprint instrument comprises a microprocessor, a fingerprint character extracting module, a real time clock module, and a communicating module. The microprocessor is respectively connected with the fingerprint character extracting module, the real time clock module and the communicating module. The central machine room is connected with the bank websites by network. The central machine room comprises a background host computer and a fingerprint server. The fingerprint server is connected with the background host computer. The teller ID verifying system can effectively avoid the ID verification of the bank tellers from the risks of attack by replaying and the invasion of a third party computer.

Owner:ZHEJIANG MIAXIS TECH CO LTD

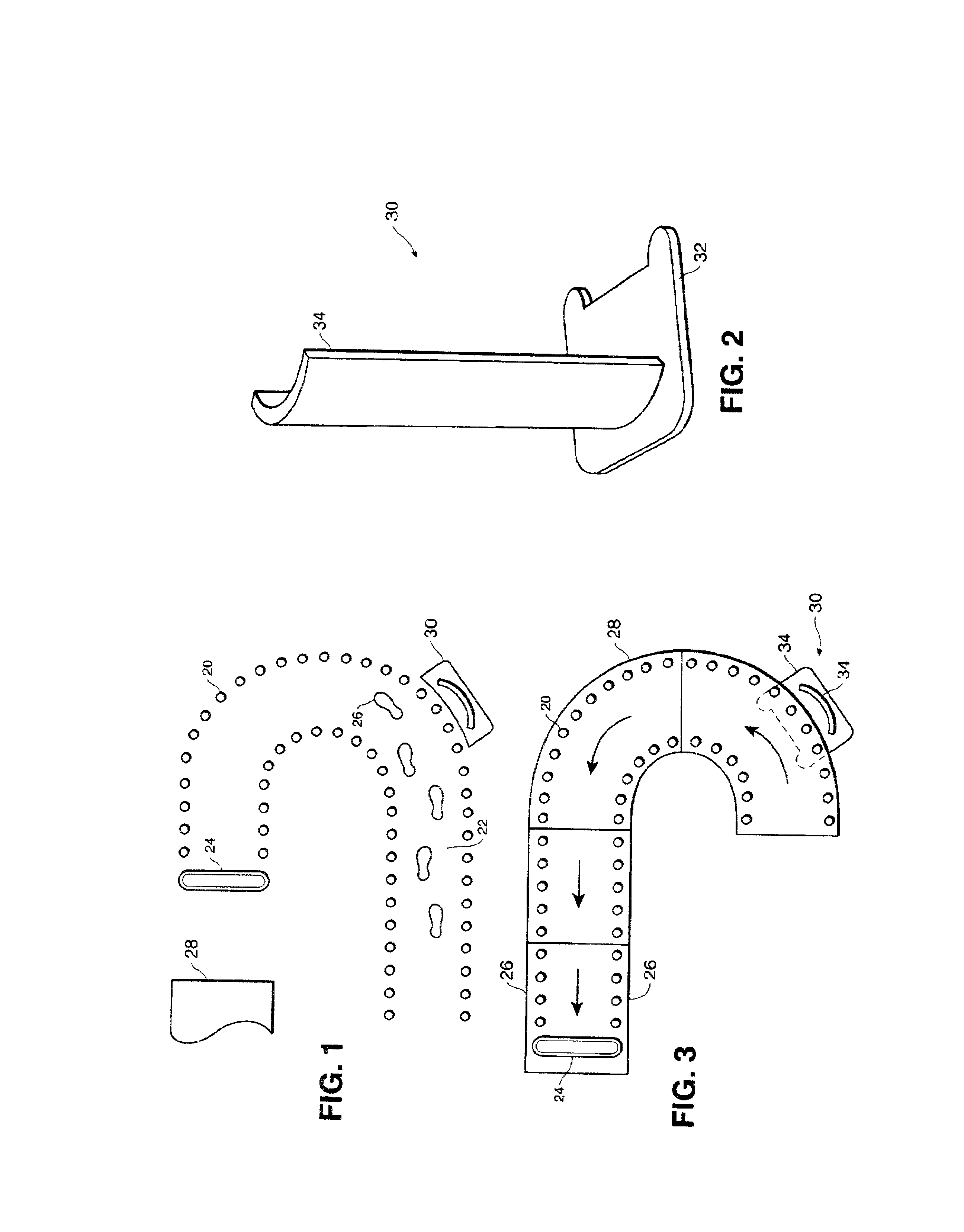

Personnel guidance and location control system

InactiveUS20010029882A1Excellent floor gripping capabilityReduce the soundAnalysis using chemical indicatorsMeasurement apparatus componentsBank tellerPhysical Marking

A personnel guidance and location control system for locating a group of individuals in a line to reach a selected destination in advance of the end of that line, such as a group of individuals waiting to reach a bank teller. The individuals are guided in a guide path by indica on one or more mats which can be conveniently disposed upon the floor of an institution and arranged to form a guide path. In addition, fixed guidance elements, such as physical markers, may be used with the floor mats in order to further identify points where the group of individuals should turn or otherwise alter directions. In addition, the mats are uniquely designed so as to present informational messages, such as advertising, or other material on a surface thereof. Further, the mats are constructed so that they are rollable, but nevertheless, very durable and do not crack or cause wrinkling of any image upon rolling thereof.

Owner:PHARO DAN +1

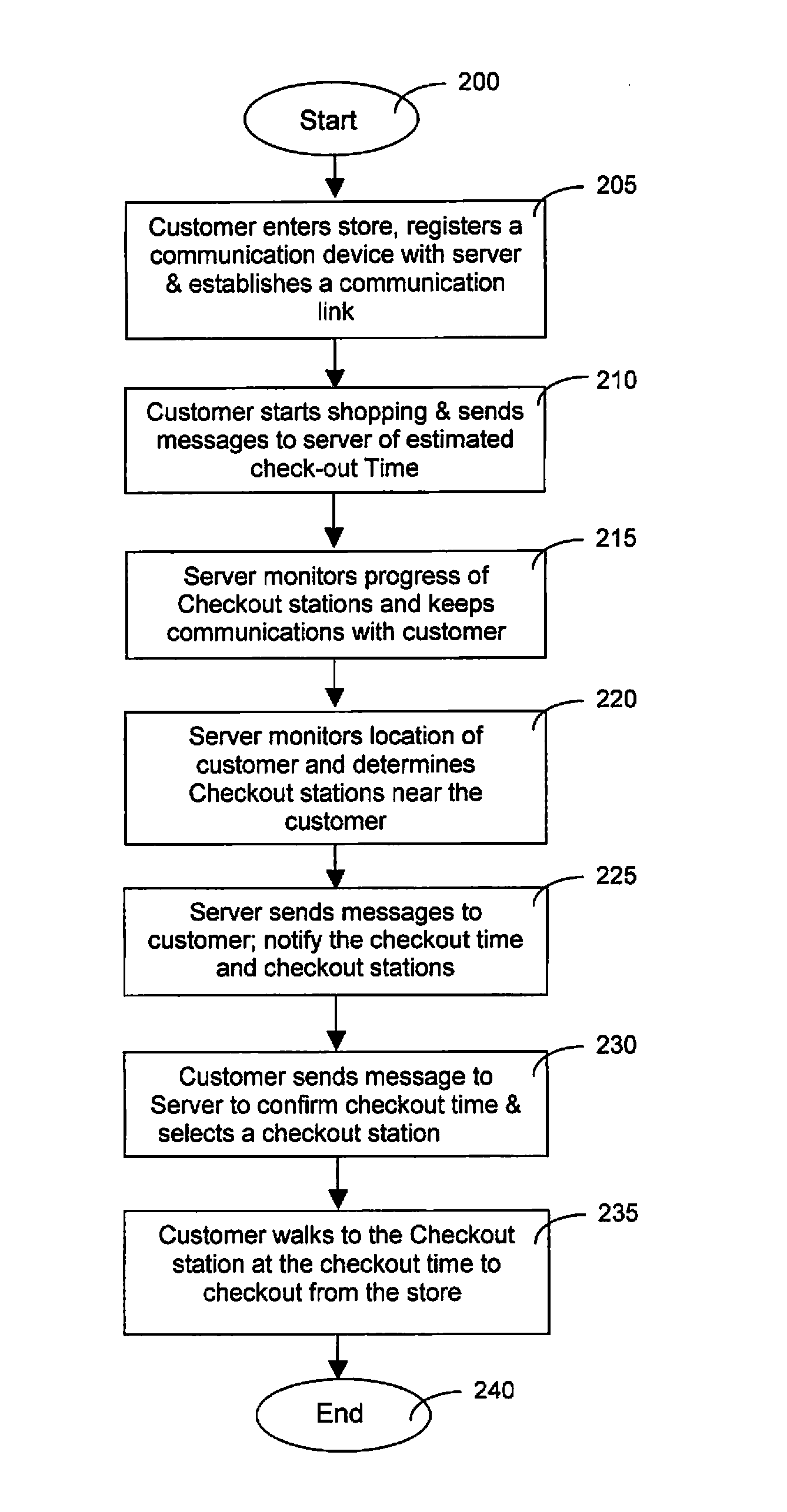

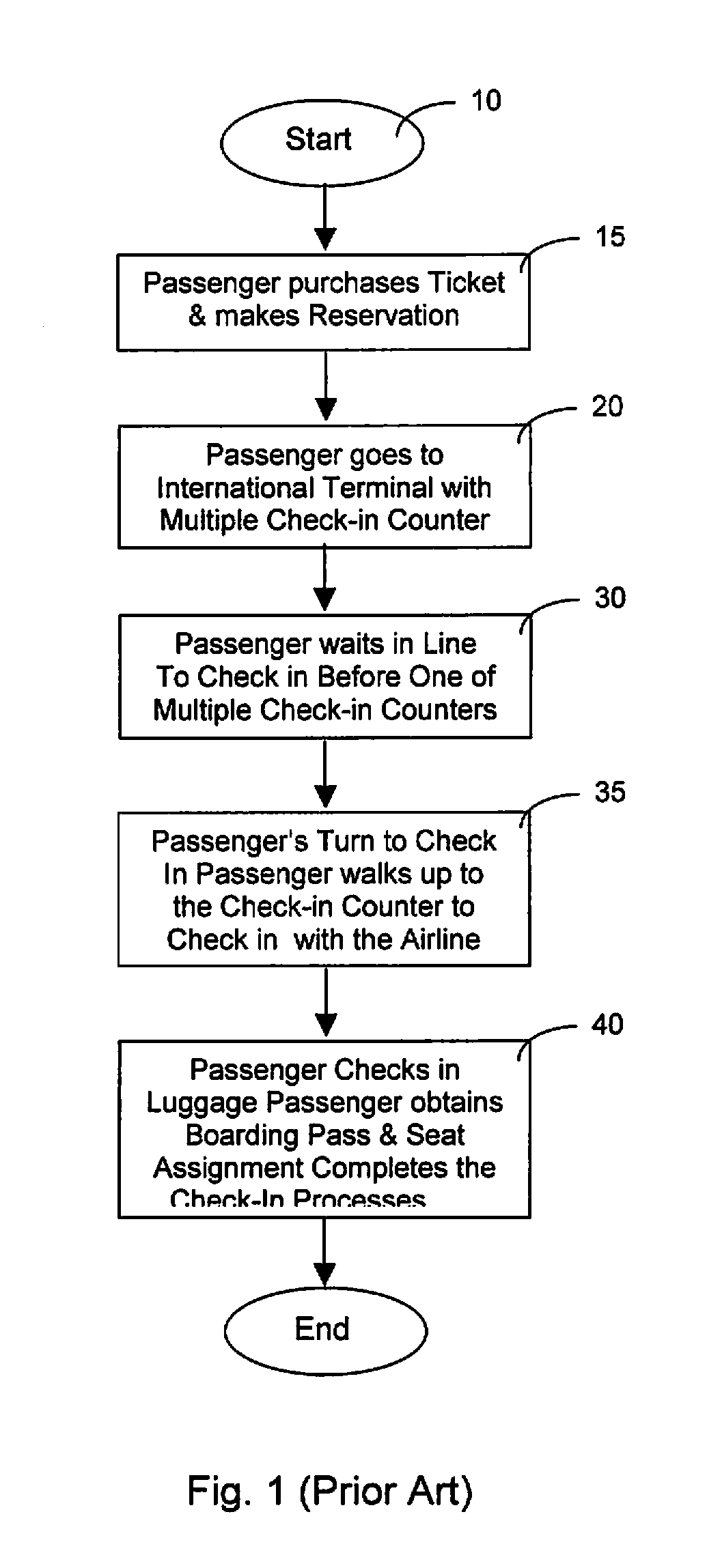

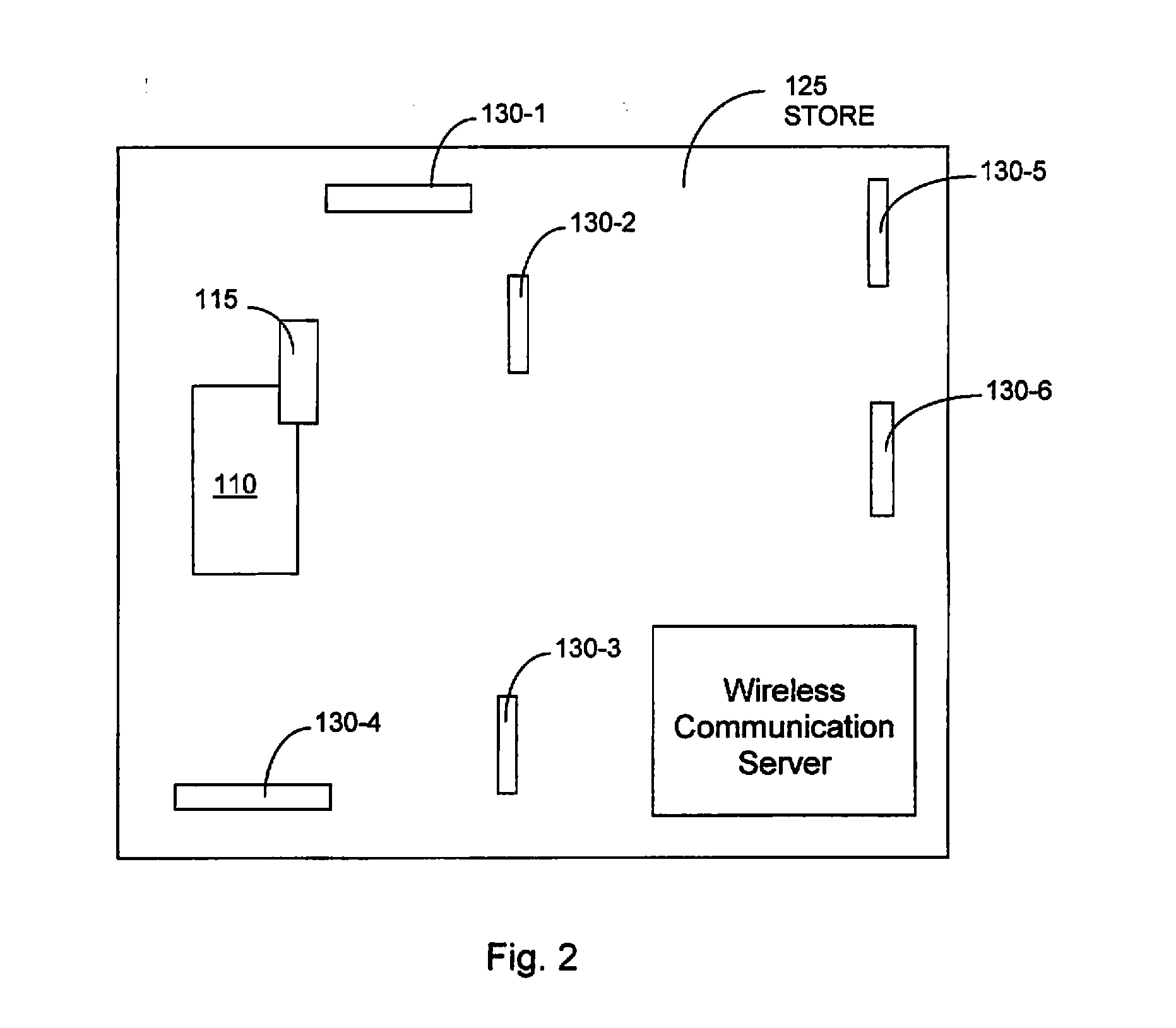

Wireless communication system for monitoring and managing client interface for area-specific process

InactiveUS20150066519A1Reduce waiting time in lineShorten the timeData processing applicationsBank tellerCommunications system

A bank customer management communication system comprises a networked communication server for communicating with a bank customer through a customer's wireless communication device by sending an estimated bank-teller available time to the customer in a bank branch office depending on an arrival time of the customer to the bank branch office for managing and reducing customer's wait time in the bank branch office.

Owner:LIN BO IN

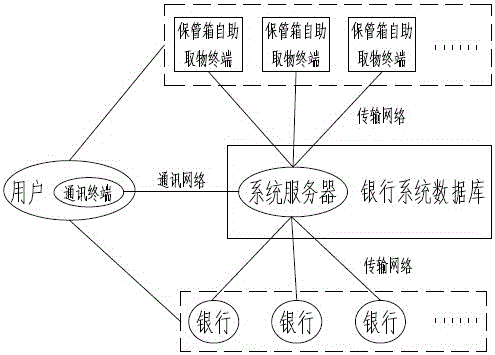

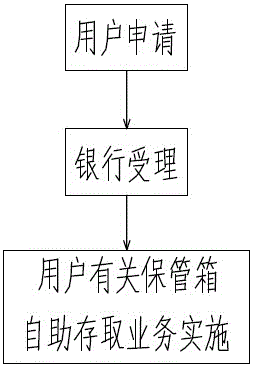

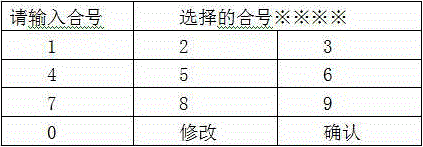

Bank self-service safety-deposit box application control and management charging system and method

InactiveCN105956916AReduce labor costsImprove efficiencyFinanceApparatus for meter-controlled dispensingPaymentBank teller

The invention relates to the technical field of financial guarantee service and specifically discloses a bank self-service safety-deposit box application control and management charging system and method. The system comprises a bank system database, a transmission network, a communication network, a system server, a safety-deposit box self-service depositing and withdrawing terminal, and a communication terminal. Through user application, bank acceptance, and self-service safety-deposit box depositing and withdrawing service of users, services, such as model selection, lease selection, payment selection, self-service depositing and withdrawing, free leasing cancellation and the like can be performed on a safety-deposit box by directly inserting a bank card into the safety-deposit box self-service depositing and withdrawing terminal and inputting a password. The system offers customers 24-hour self-service, avoids manual management operation procedures, treated by bank tellers, such as tenancy registration, management charging, tenancy cancellation, and accompanied depositing and withdrawing, greatly reduces the manpower management cost of the operation units, offers convenient, quick, safe and secure manpower management depositing and withdrawing conditions to users so as to further improve the application functions of the self-service safety-deposit box.

Owner:广东垒亚安防科技有限公司

Method and system for automated value transfer

This invention provides a system and method for authorizing automated value transfers from an account available to users who do not have a pre-existing trust, business or financial relationship. In an embodiment of the present invention, a Sender at a first location purchases a PIN Card at a point of sale, such as a retail location or a bank teller. The Sender contacts an intended Recipient at a remote location and discloses a Transfer PIN associated with the PIN Card, as well as the amount being transferred, to that intended Recipient. The Recipient needs only the Transfer PIN and a Cash Card to receive the money transfer at a participating remote location. To receive the value associated with the PIN Card, the Recipient inserts or swipes the Cash Card at an ATM and enters the Transfer PIN. An authorization system then authorizes the dispensing unit to dispense that value amount.

Owner:ACE SERIES A HOLDCO

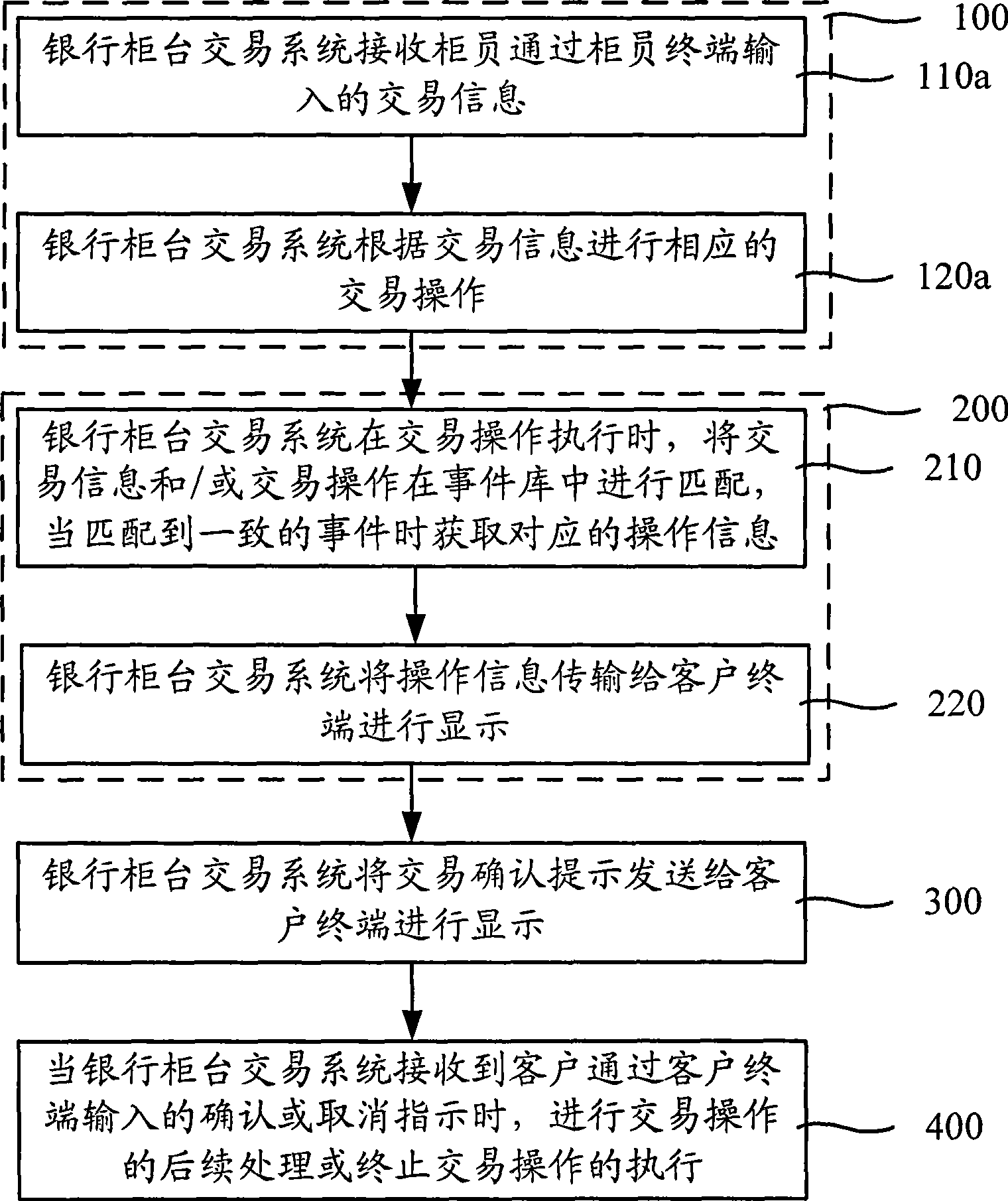

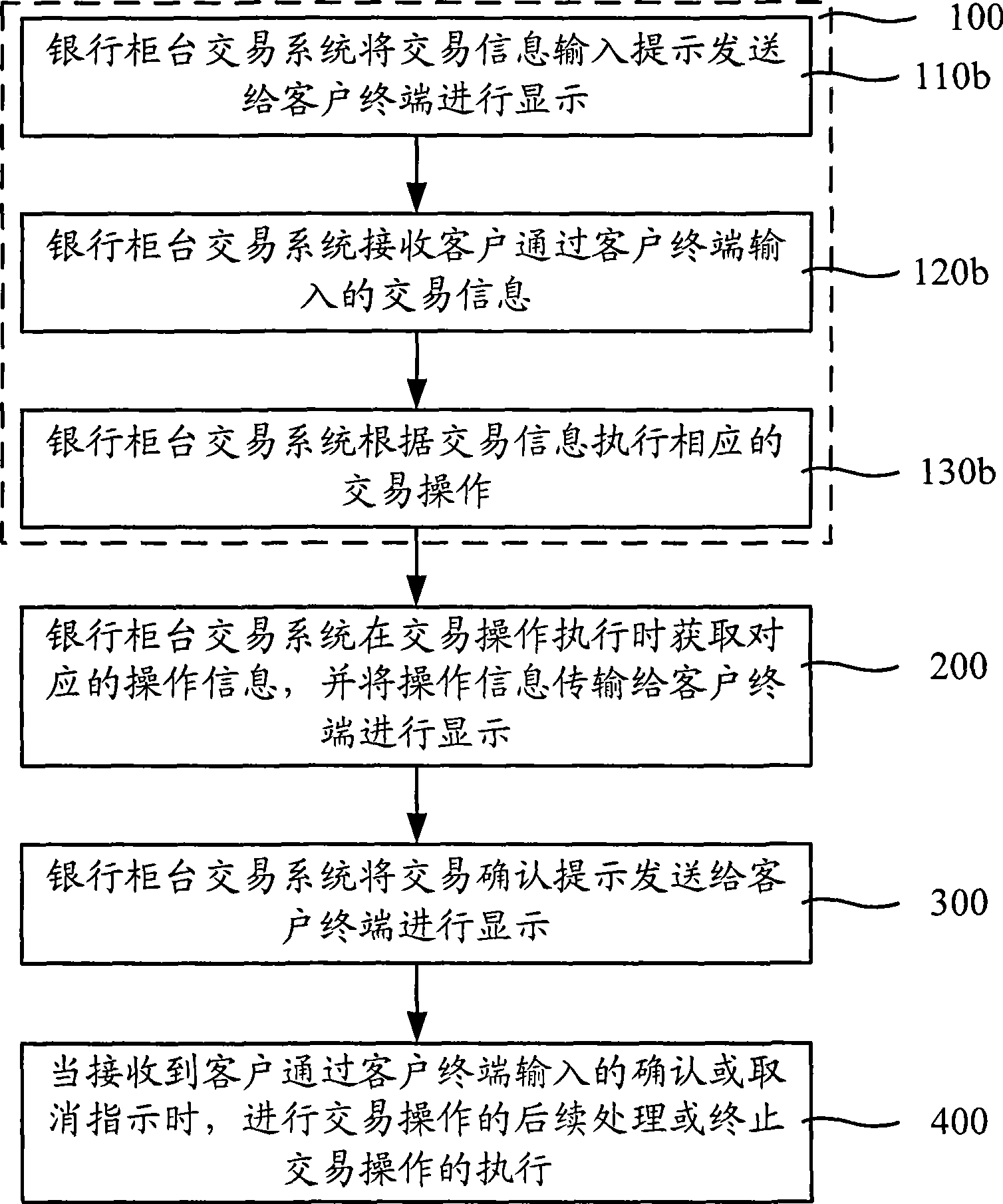

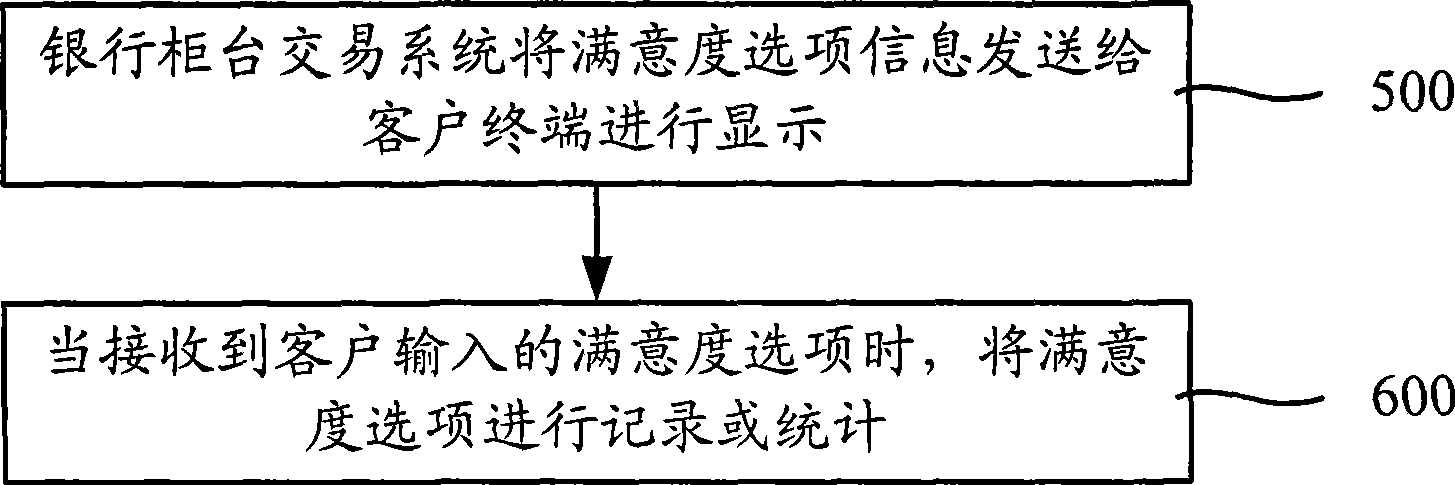

Bank counter transaction process implementing method, transaction system and customer terminal

InactiveCN101383067AEliminate illegal operationsReduce operational riskComplete banking machinesBank tellerFinancial transaction

The invention relates to a realizing method for a bank counter transaction process, a bank counter transaction system and a client terminal. The method comprises the following steps: the bank counter transaction system receives input transaction information and executes transaction operation; corresponding operation information is acquired and transmitted to the client terminal for display; a transaction confirmation prompt is displayed on the client terminal; when receiving confirmation prompt input into the client terminal, the sequent treatment of the transaction operation is executed. The transaction system comprises a counter terminal interface, a client terminal interface, an executing module, an acquisition module and a confirmation module. The client terminal comprises a system interface, an information prompt module and an information input module. The transaction system and the client terminal are cooperated to execute the realizing method for a bank counter transaction process. In the invention, the operation information which is carried out by a bank dealer serving a client is displayed on the client terminal and is confirmed by the client so that the client has an acknowledge right and a transaction monitoring right. The invention can avoid the violation operation of dealers, decreases the operation risk, and improves the transaction experiences of clients.

Owner:CHINA CONSTRUCTION BANK

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com