Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

976results about "ATM softwares" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

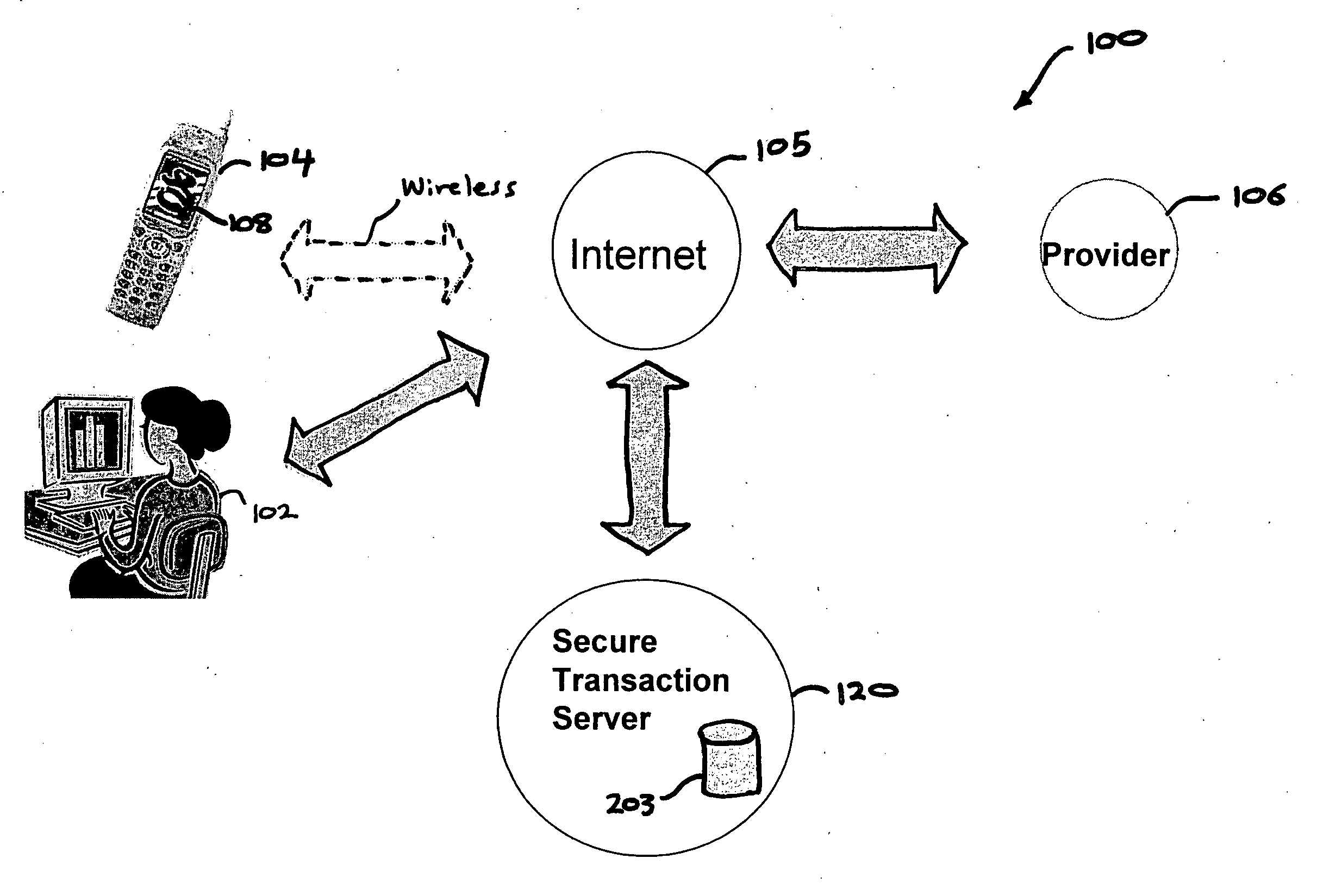

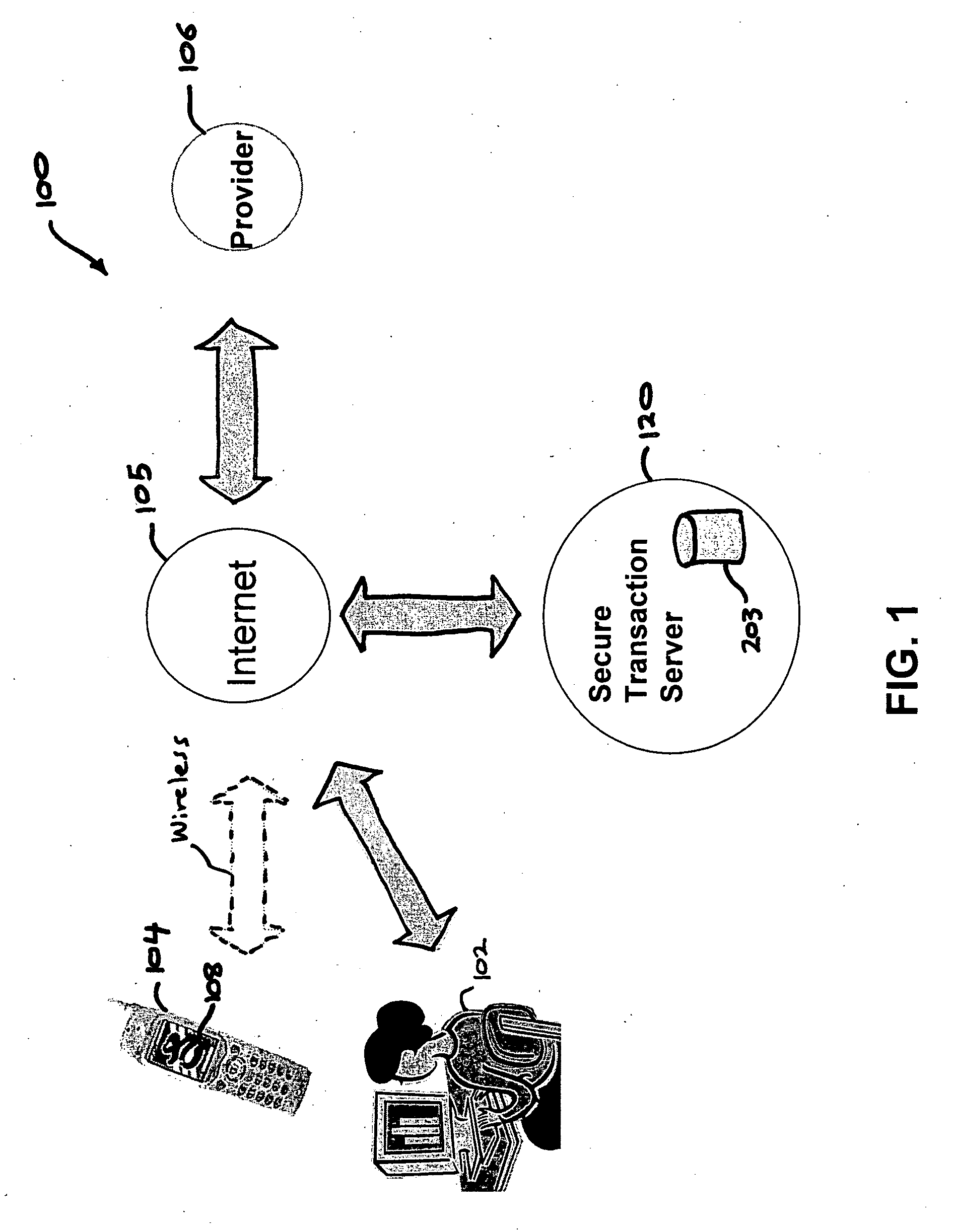

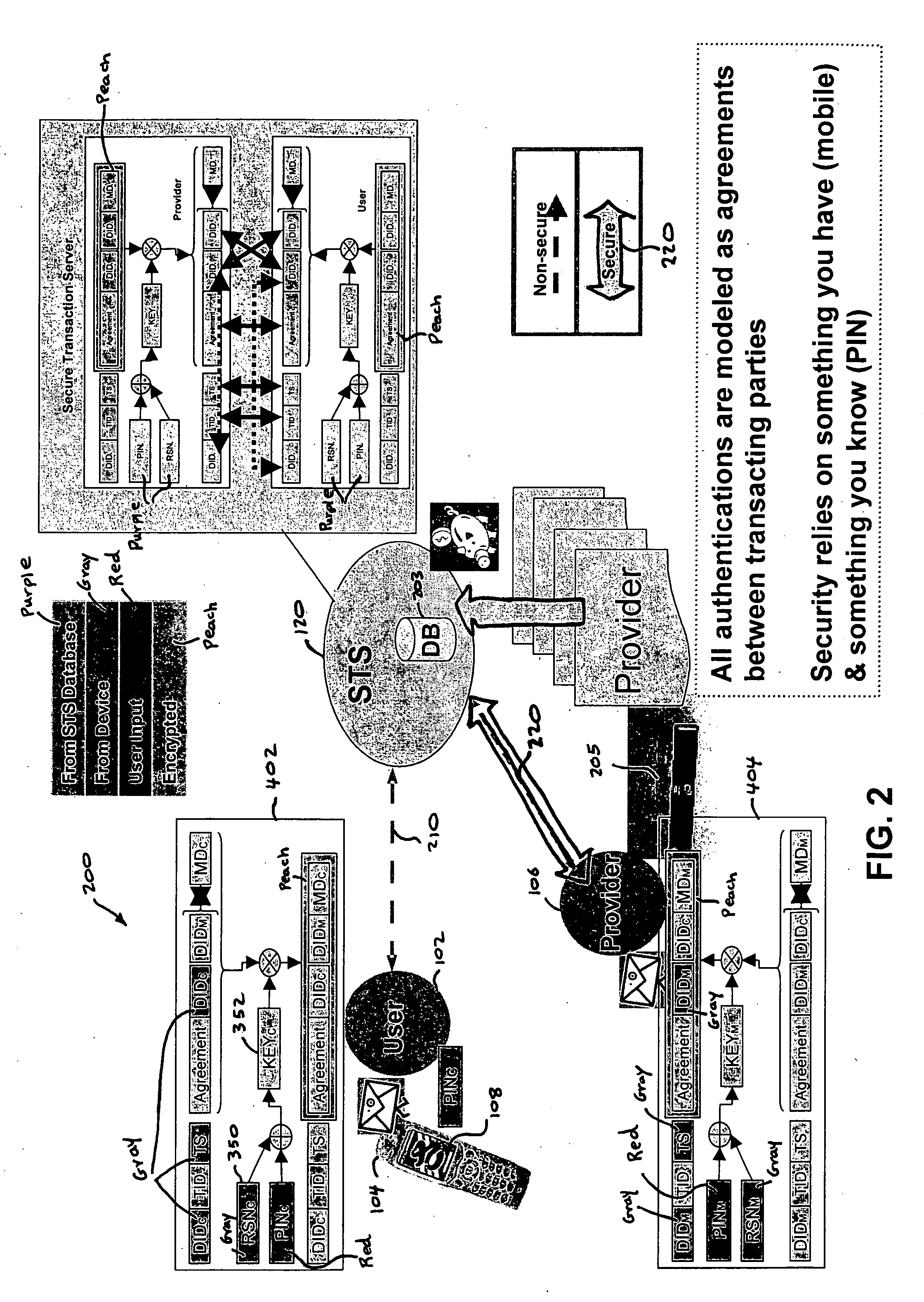

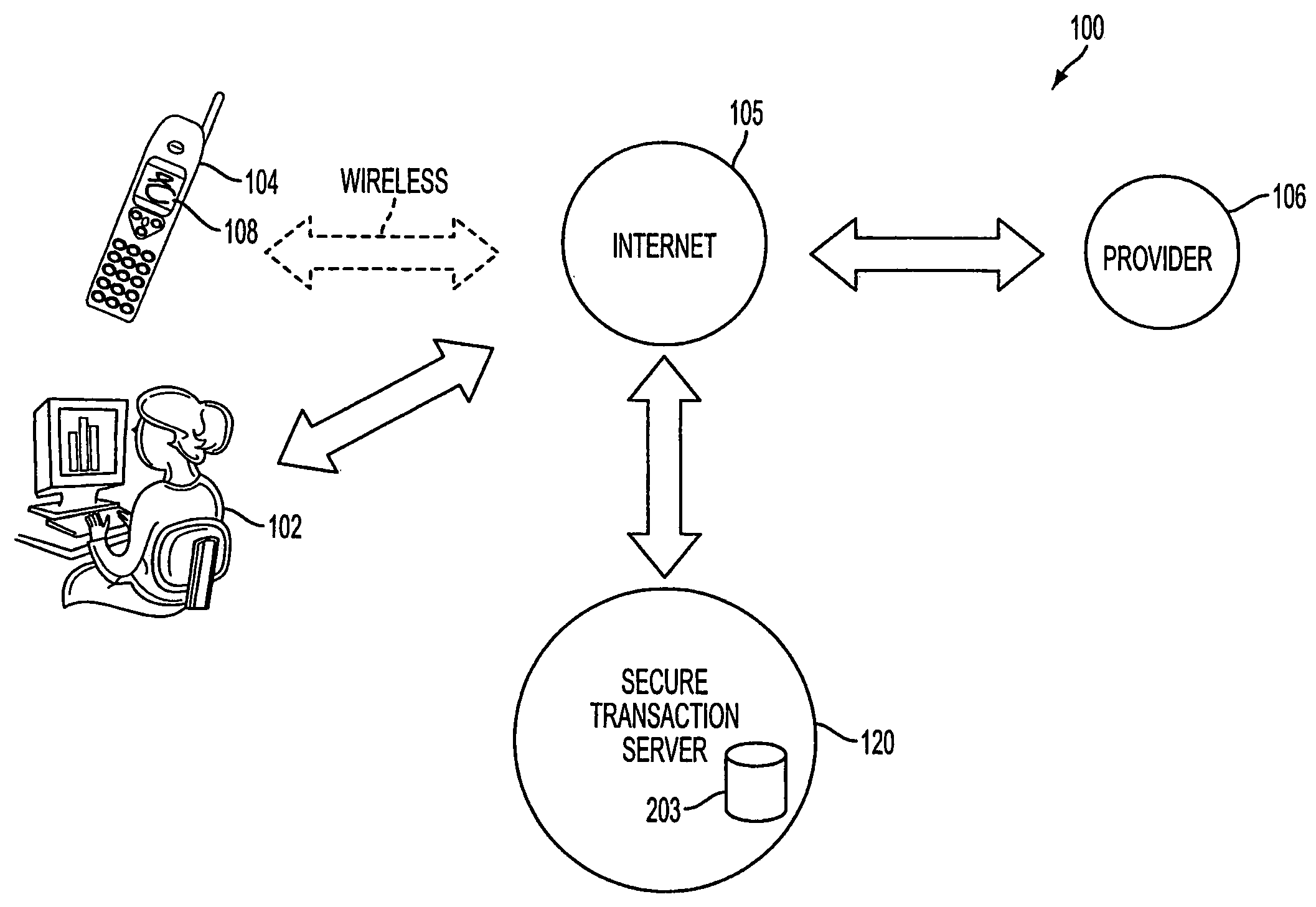

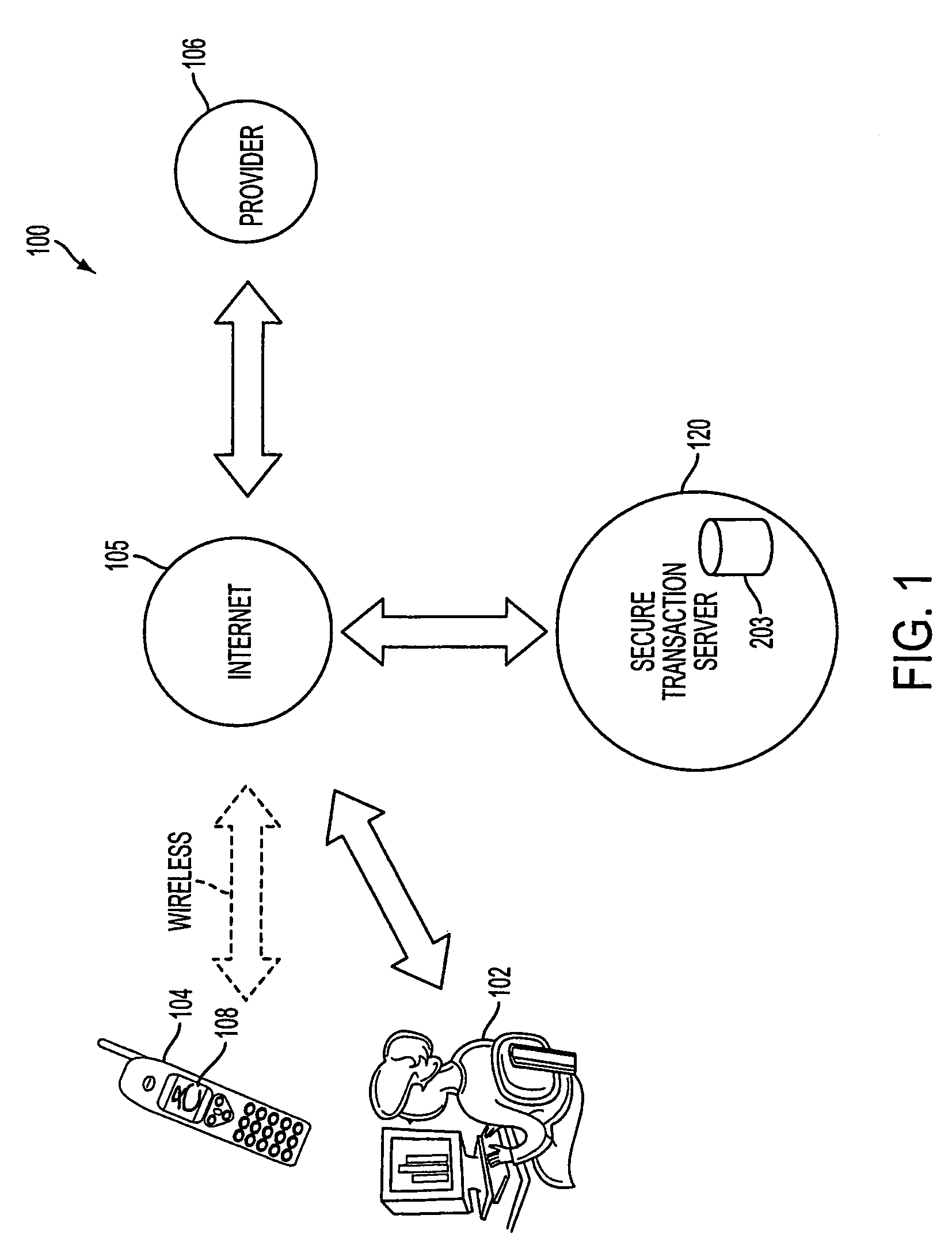

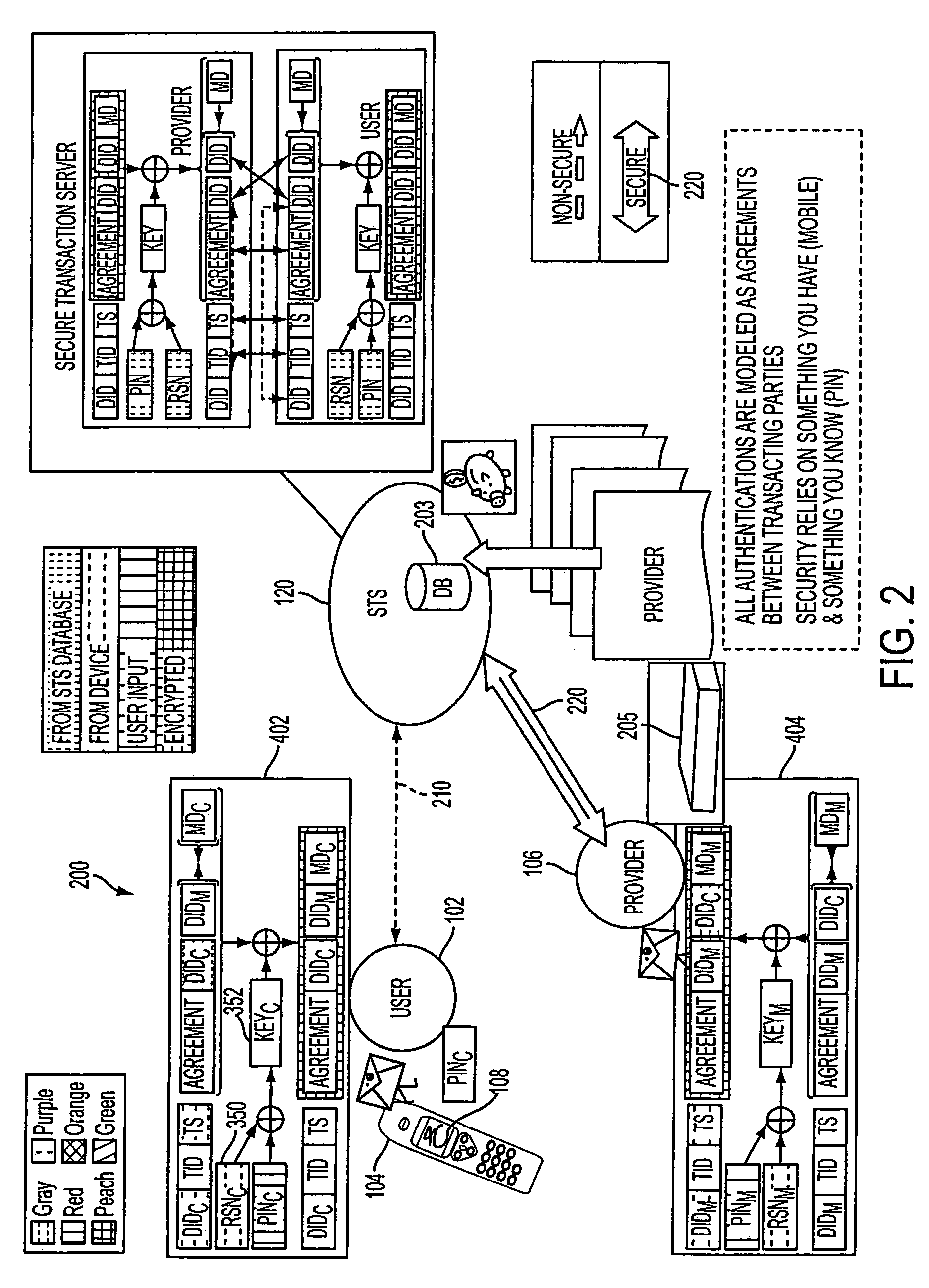

Authentication services using mobile device

InactiveUS20060206709A1Payment architectureATM softwaresInternet Authentication ServiceMobile device

A method, and an apparatus performing the method, is provided by authenticating a mobile device communicably connectable to a wireless network by an authentication parameter from a secure transaction server (STS), as a mobile device authenticator; providing an STS correlation between a personal identification entry (PIE) and the mobile device authenticator; and inputting, by a user, the PIE and a provider action, to the mobile device authenticator to transmit a transformed secure user authenticable authorization request to the STS over the wireless network to authorize an action with a provider.

Owner:PCMS HOLDINGS INC

Authentication services using mobile device

InactiveUS7606560B2Unauthorised/fraudulent call preventionEavesdropping prevention circuitsInternet Authentication ServiceMobile device

A method, and an apparatus performing the method, is provided by authenticating a mobile device communicably connectable to a wireless network by an authentication parameter from a secure transaction server (STS), as a mobile device authenticator; providing an STS correlation between a personal identification entry (PIE) and the mobile device authenticator; and inputting, by a user, the PIE and a provider action, to the mobile device authenticator to transmit a transformed secure user authenticable authorization request to the STS over the wireless network to authorize an action with a provider.

Owner:PCMS HOLDINGS INC

Automated banking machine system and method

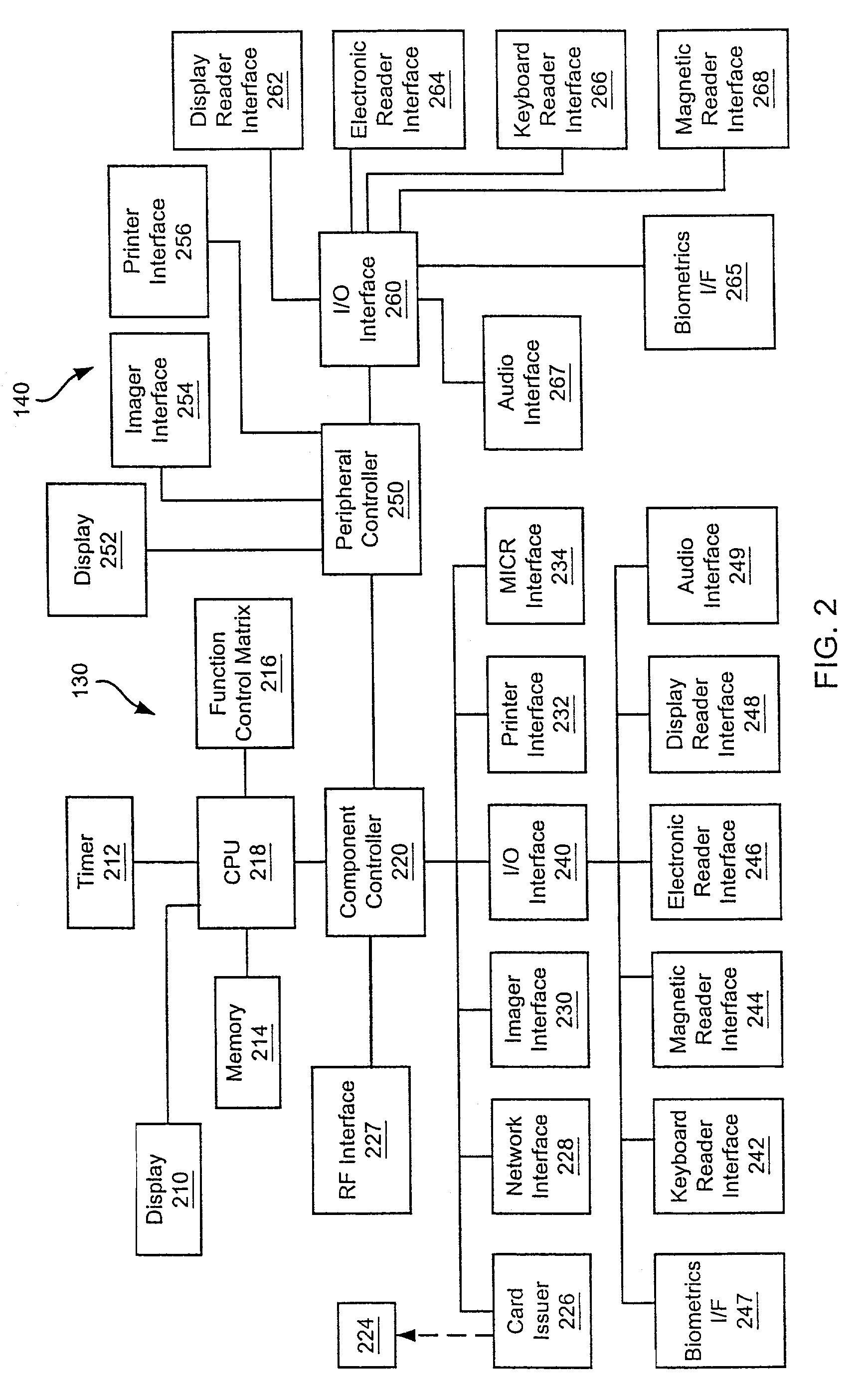

InactiveUS20030217005A1Good user interfaceFunction increaseBuying/selling/leasing transactionsSpecific program execution arrangementsEmail addressCheque

A system and method of providing an electronic transaction receipt from a cash dispensing ATM. A bank host computer is operable to submit the receipt to a system address of record with the bank. The address of record corresponds to an e-mail address, phone number or other address associated with an account involved in the transaction. The receipt may include an image or images associated with the transaction. Thus, a user of an ATM is able to receive an electronic receipt corresponding to the ATM transaction. The system may also operate to image deposited checks deposited at an ATM. Copies of the imaged checks and other information can be electronically sent to a maker, payee, a clearinghouse or banks involved with the transaction. The system may also operate to provide the user with blank checks in hard copy or virtual checks for transactions.

Owner:DIEBOLD NIXDORF

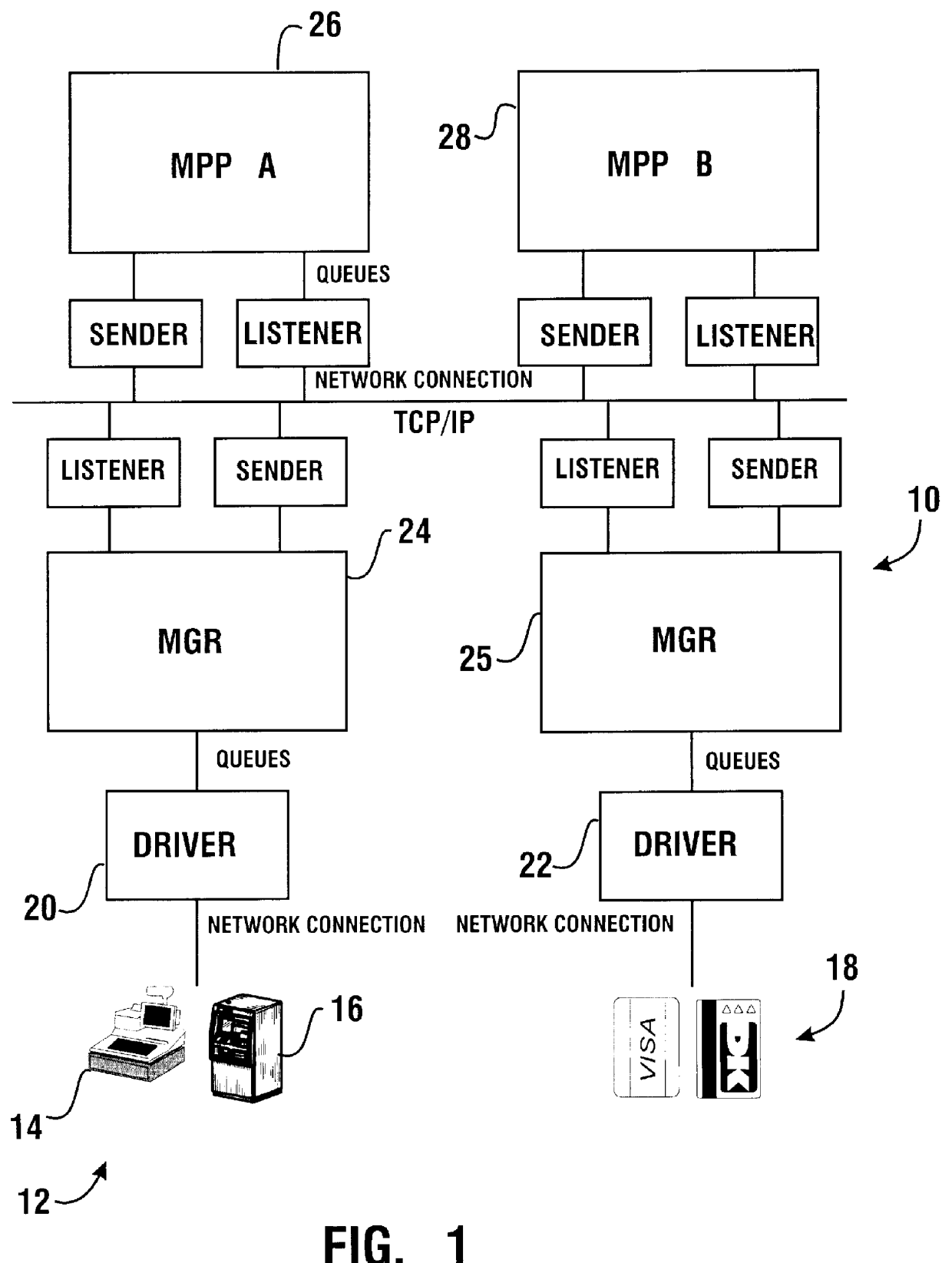

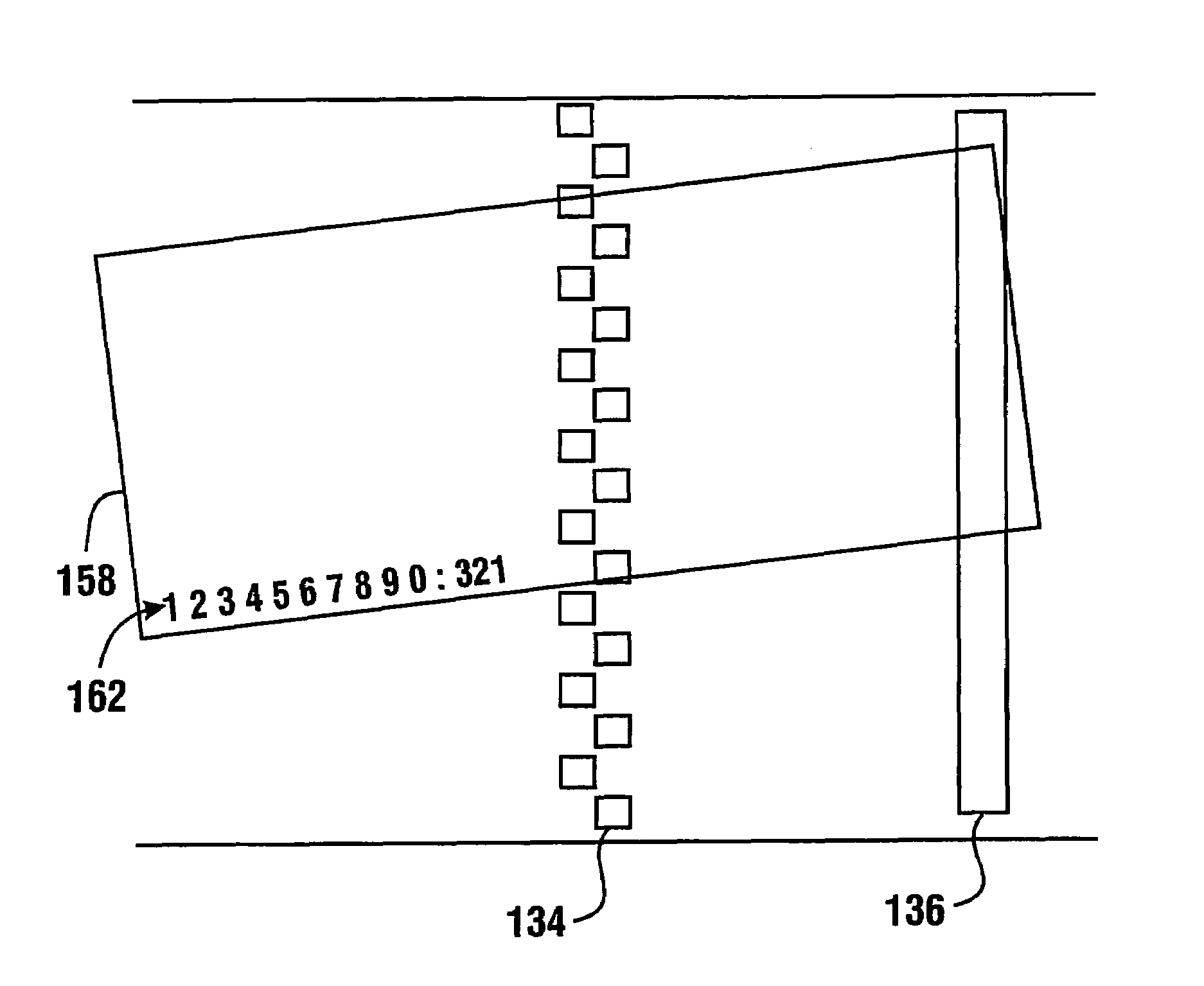

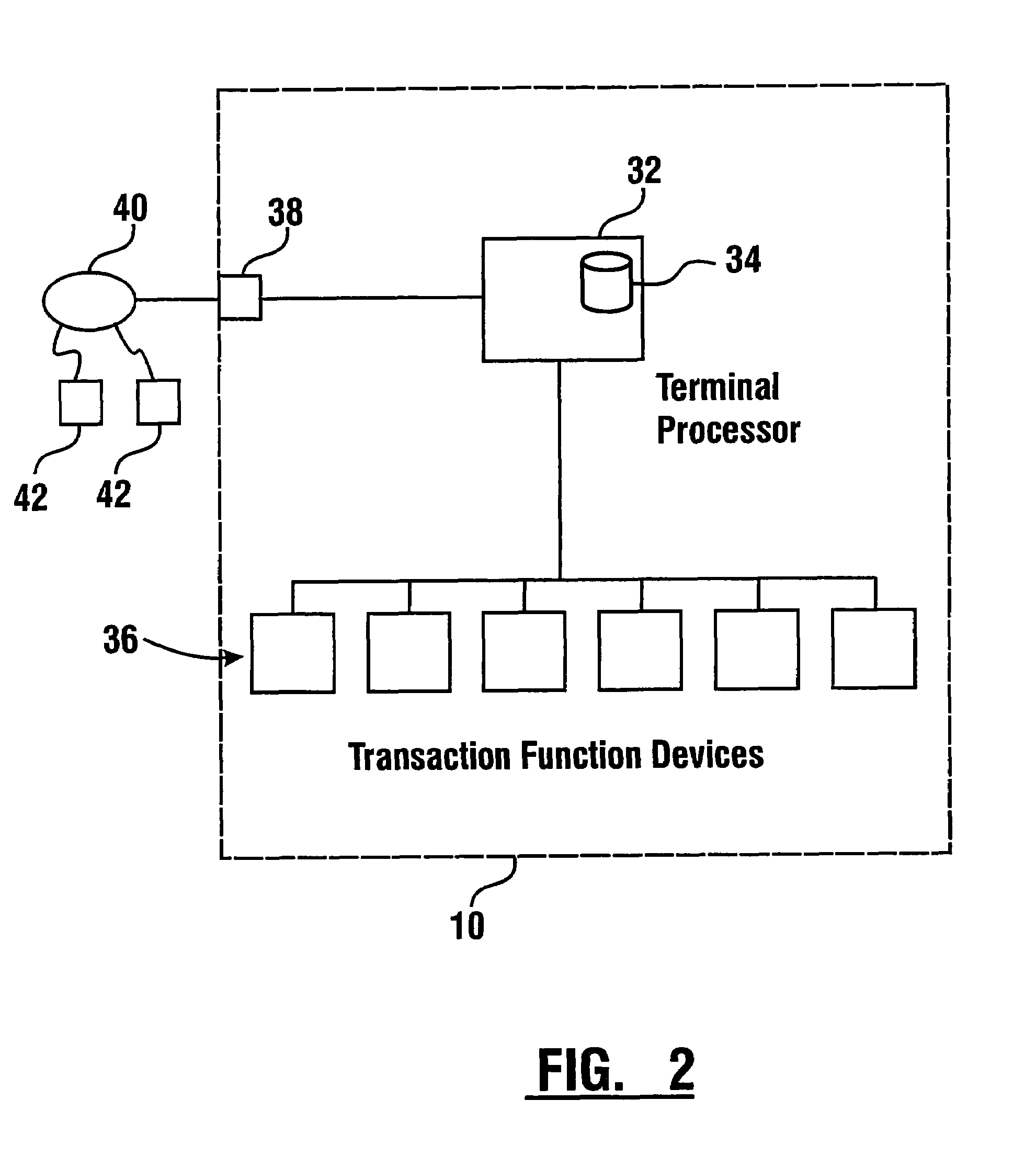

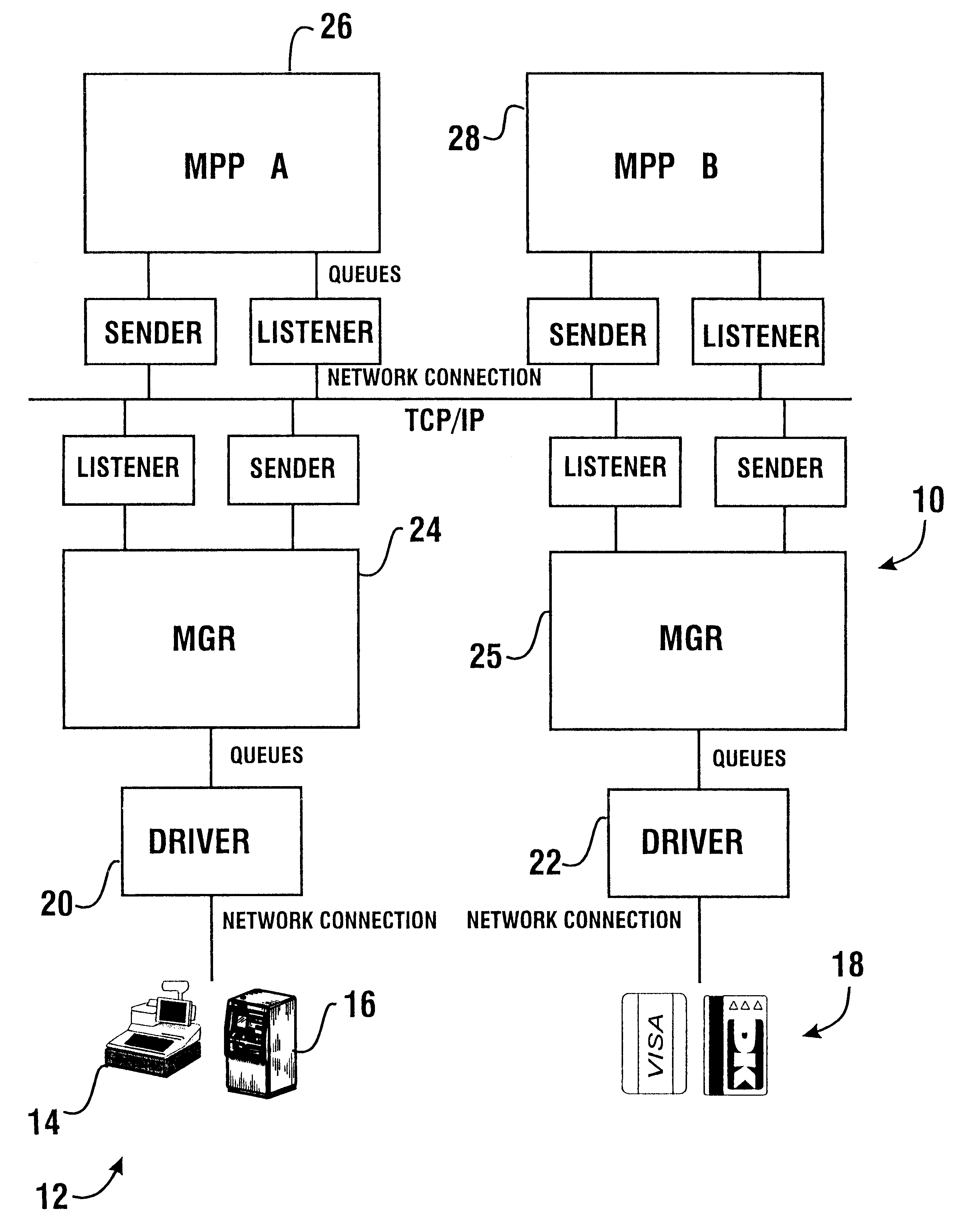

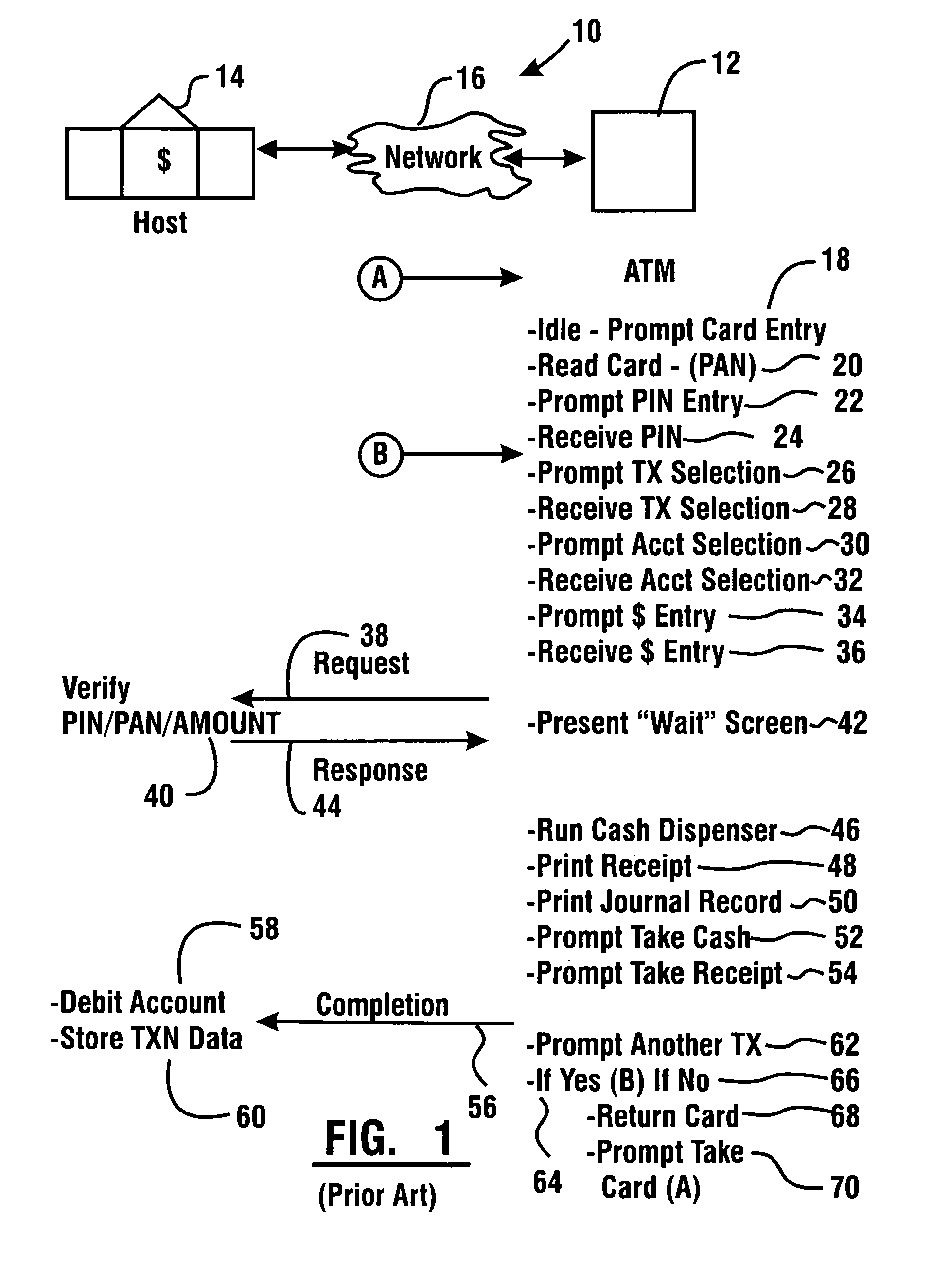

Financial transaction processing system and method

InactiveUS6039245AEasy to develop and modifyEasy to changeComplete banking machinesHand manipulated computer devicesRelational databaseTerminal equipment

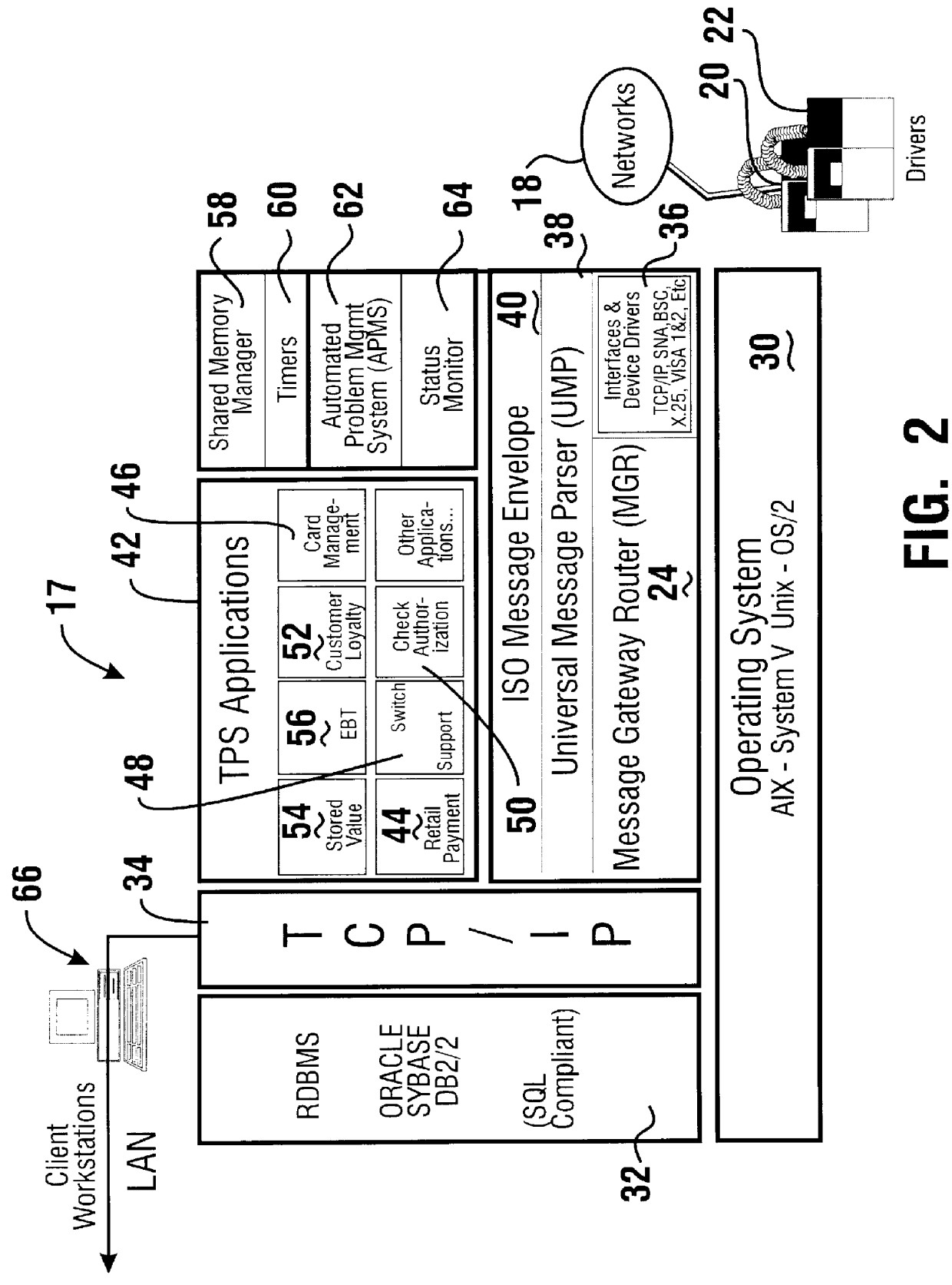

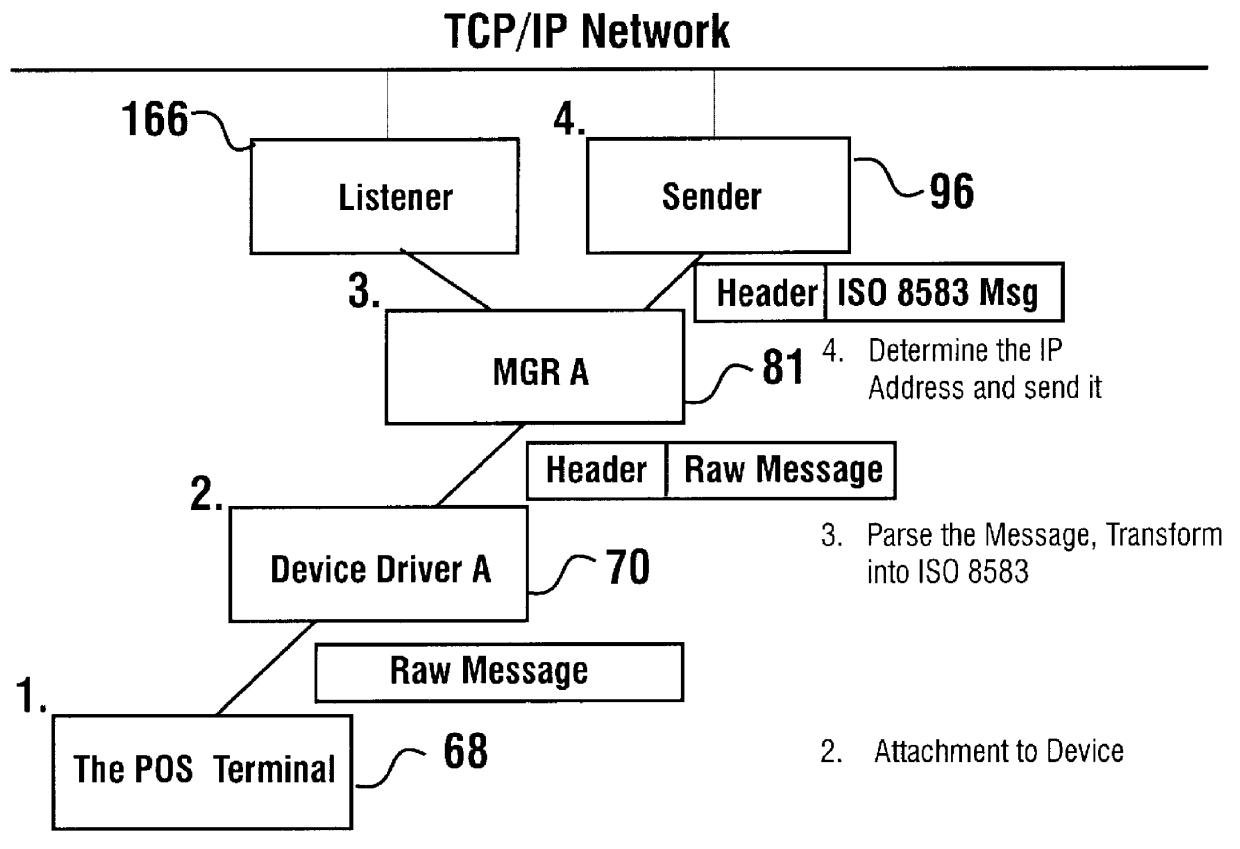

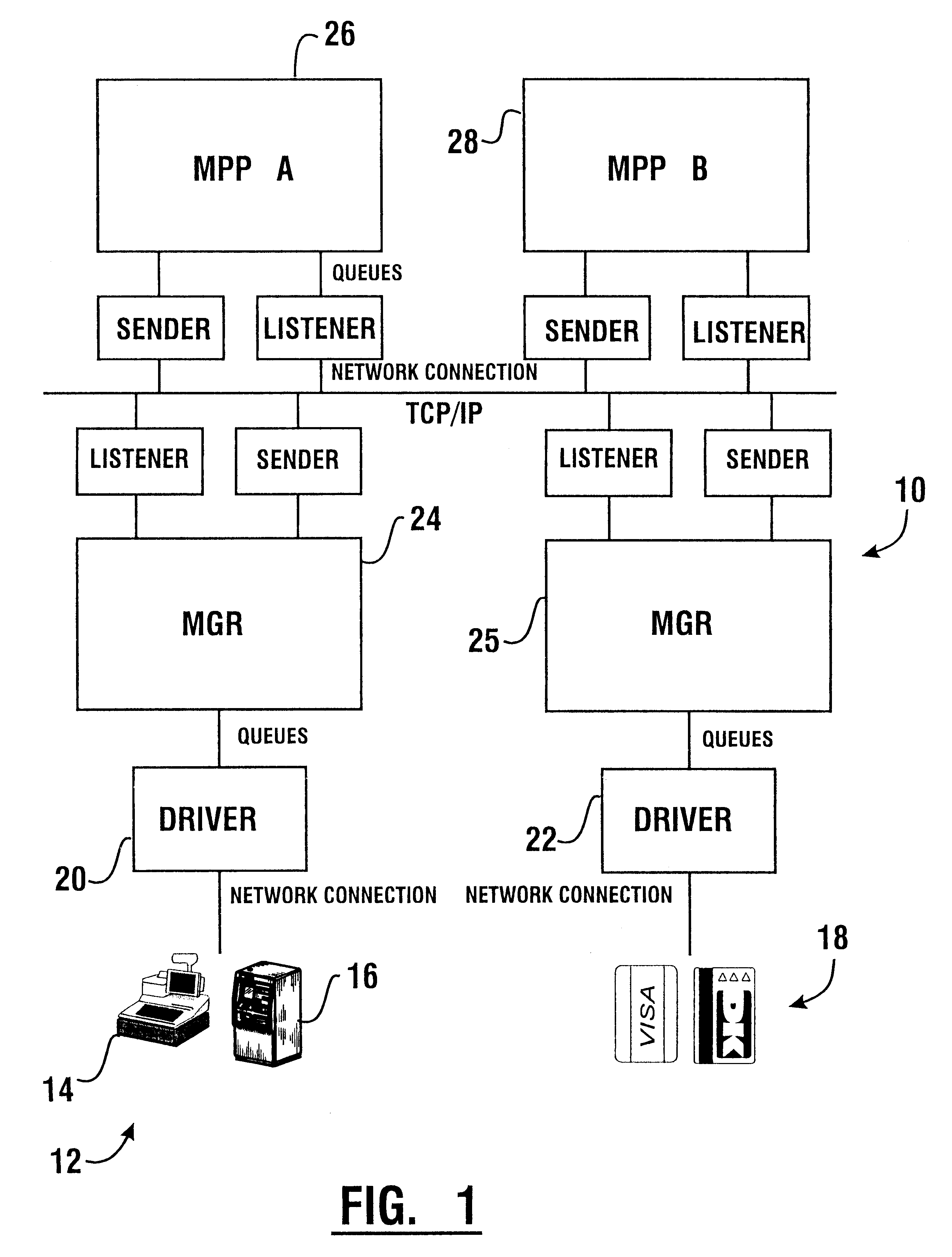

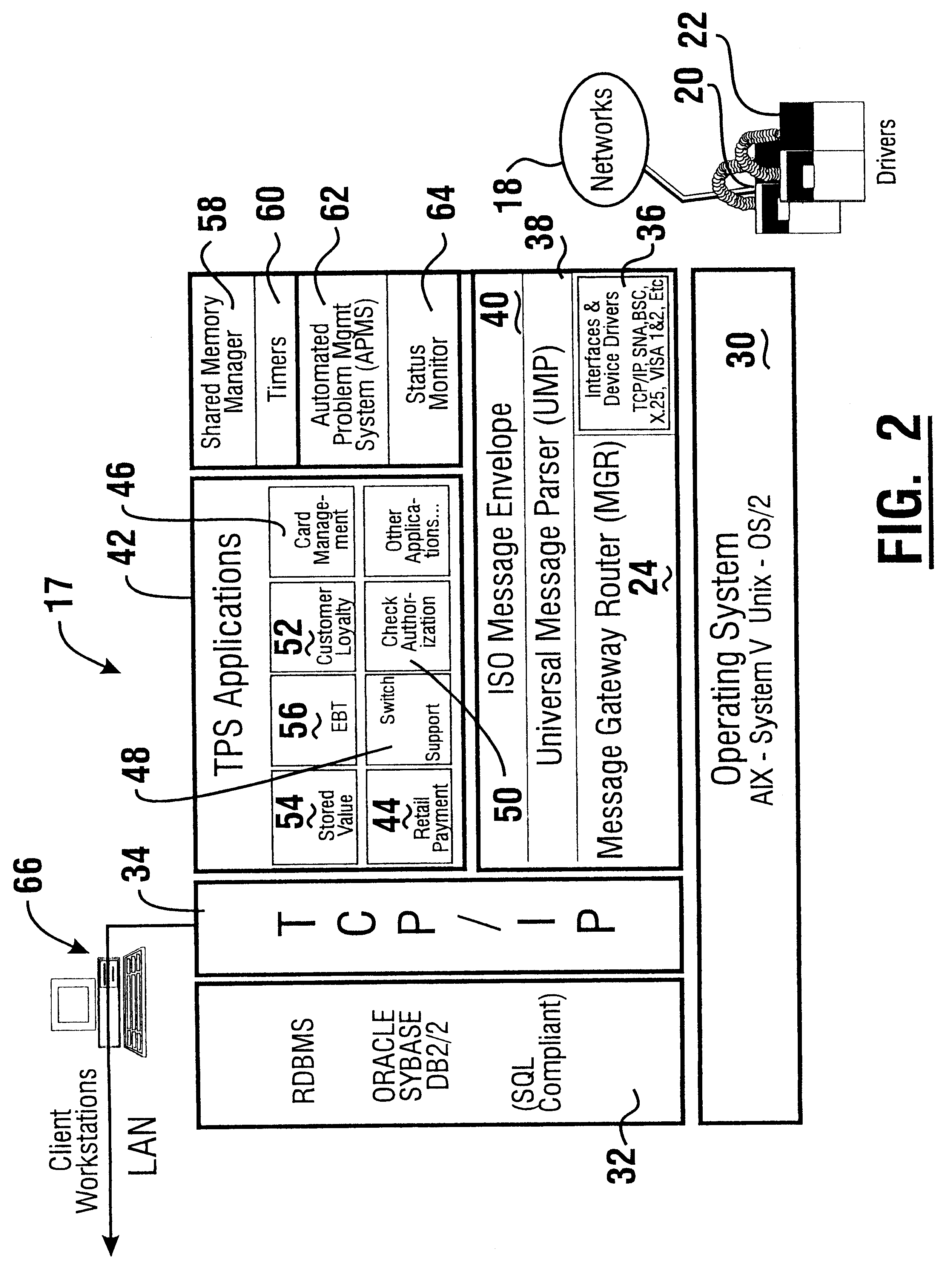

A financial transaction processing system (10) enables processing transactions from various types of card activated terminal devices (12) which communicate using a variety of electronic message formats. The transaction processing system may operate to authorize transactions internally using information stored in a relational database (32) or may communicate with external authorization systems (18). The transaction processing system includes among its software components message gateway routers (MGRs) (24, 164) which operate using information stored in the relational database to convert messages from a variety of external message formats used by the external devices and authorization systems, to a common internal message format used within the system. The system further uses database information to internally route messages to message processing programs (MPPs) (108, 138) which process messages and generate messages to the external devices and authorization systems. The MGR also converts the outgoing messages from the internal message format to the external message formats which can be interpreted by the external devices and systems to which the messages are directed.

Owner:DIEBOLD NIXDORF

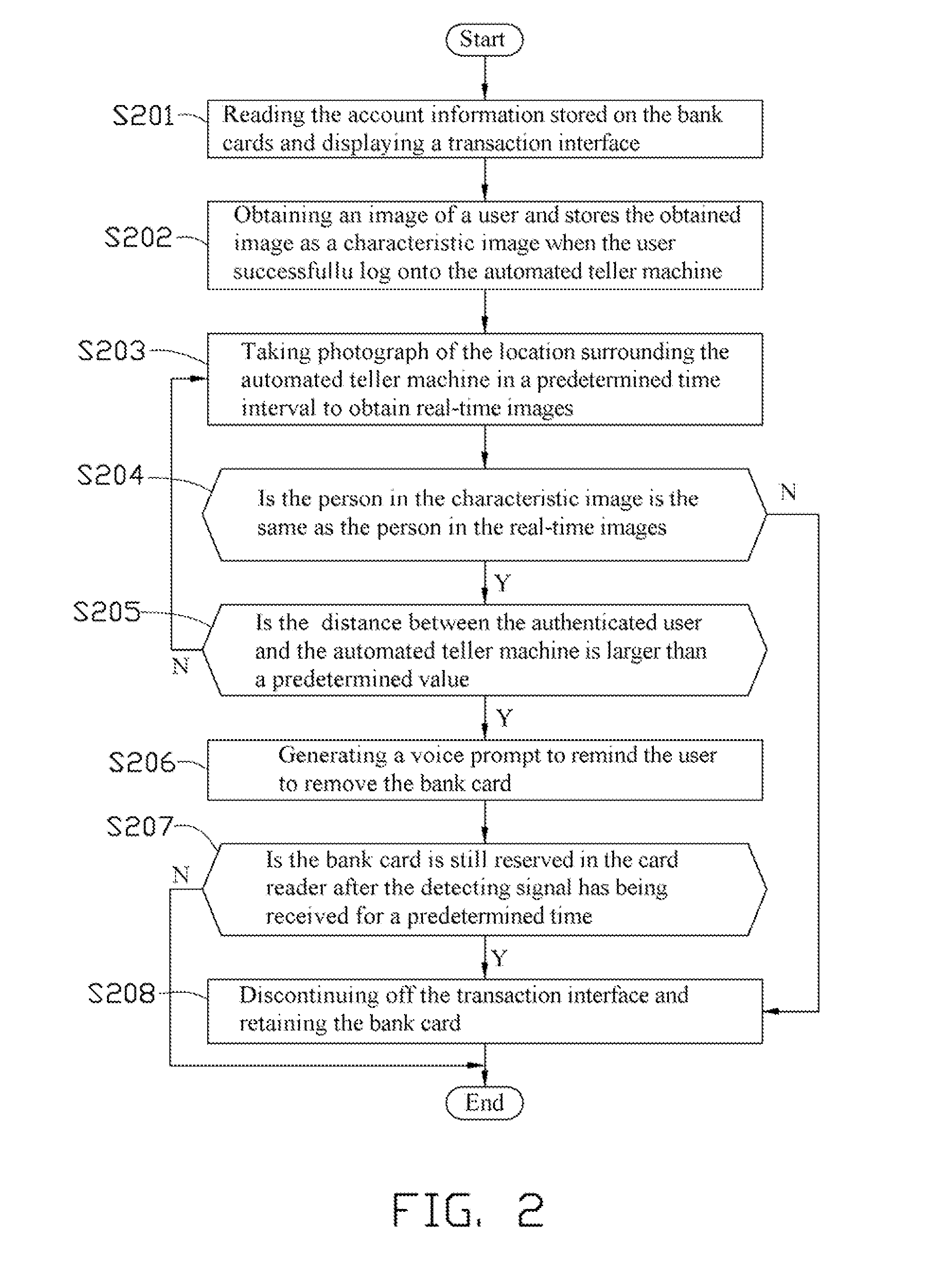

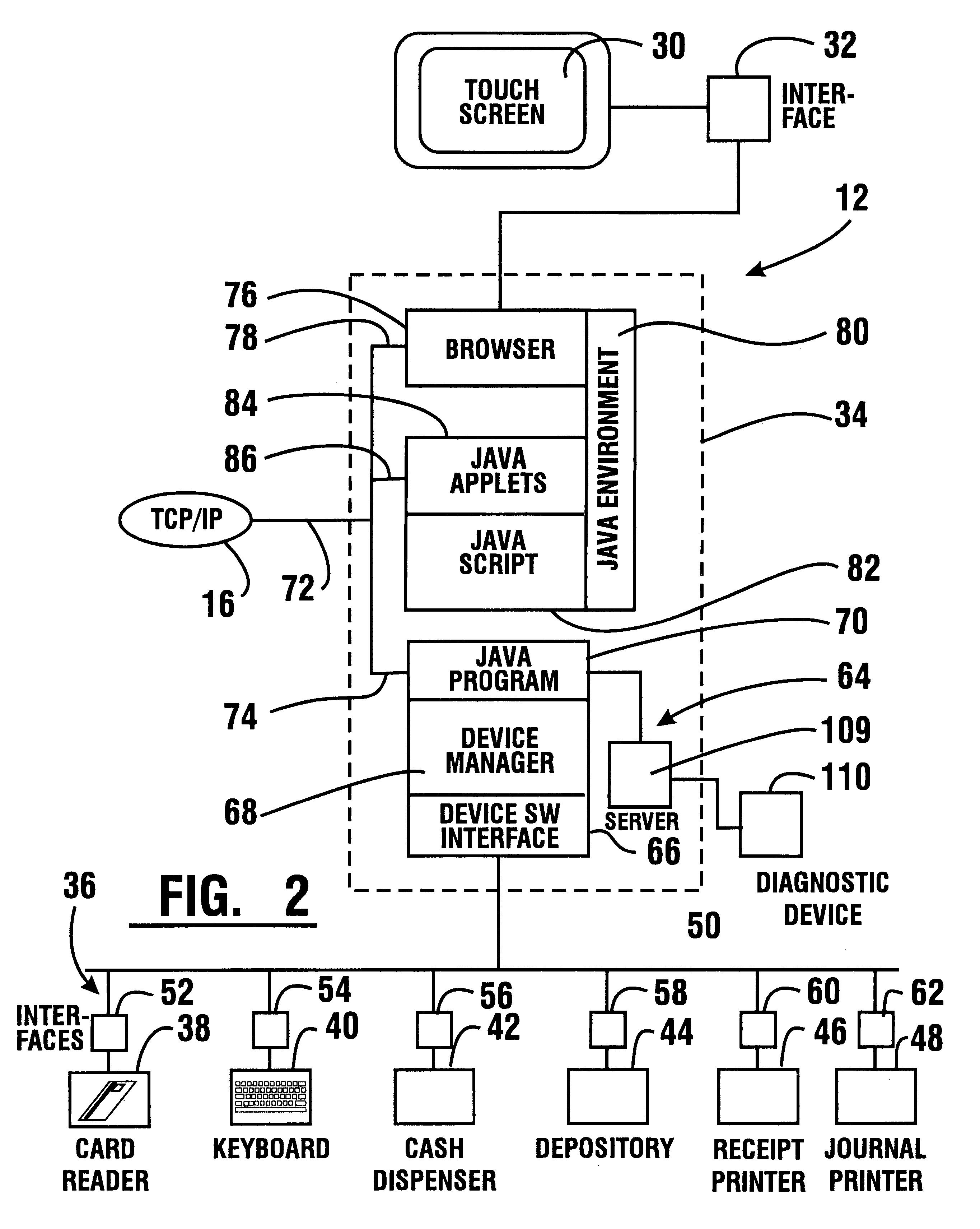

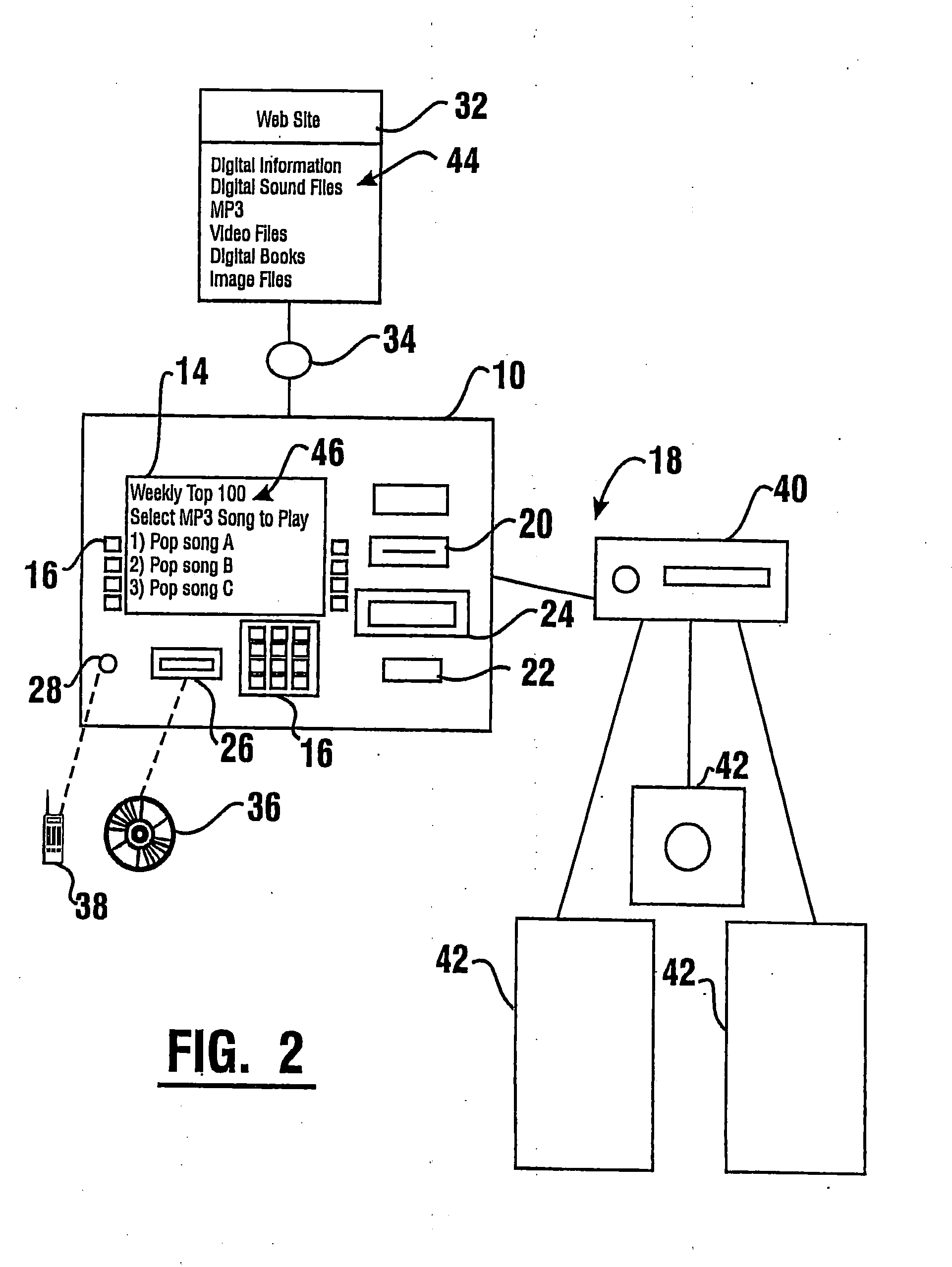

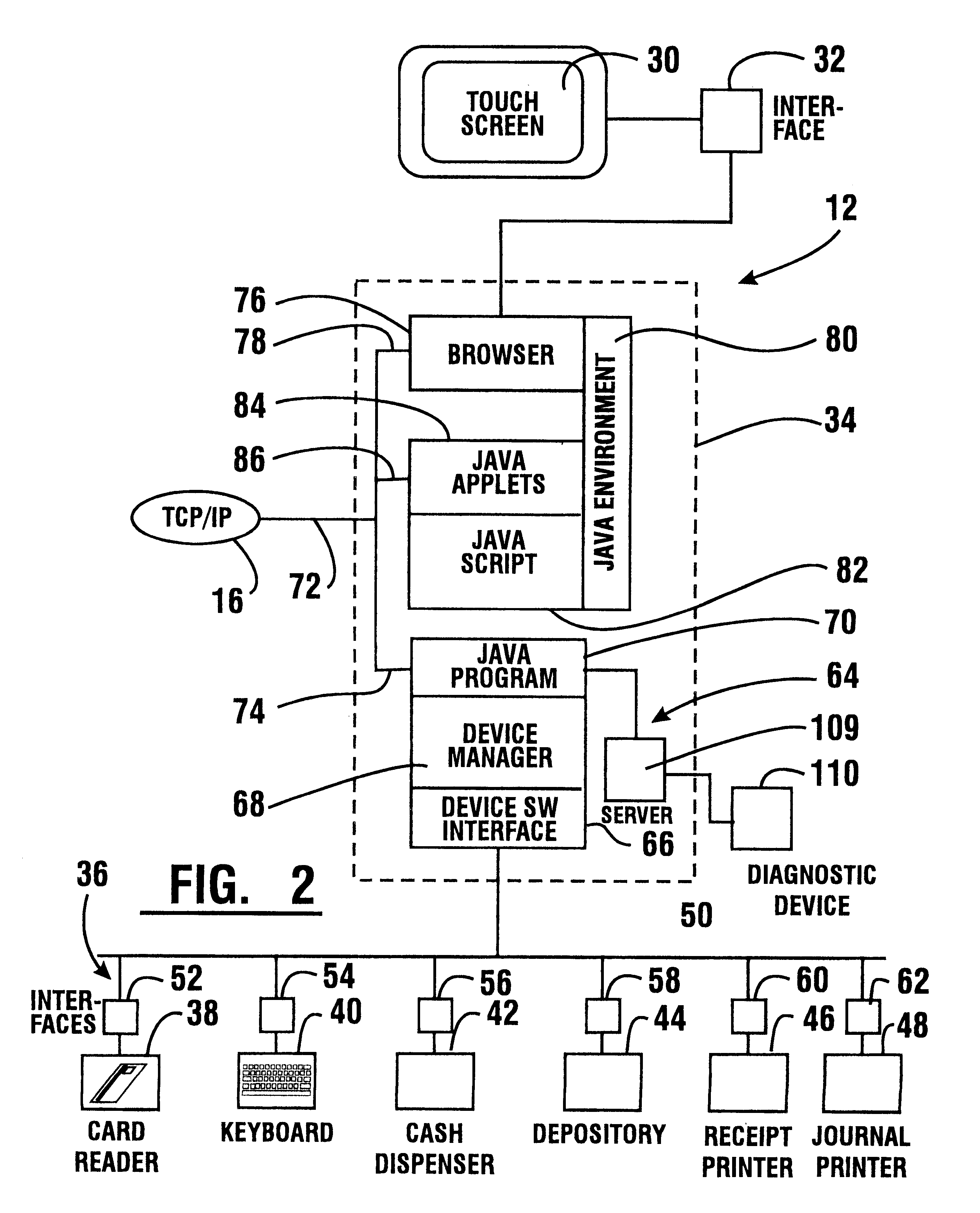

System and method for providing global self-service financial transaction terminals with worldwide web content, centralized management, and local and remote administration

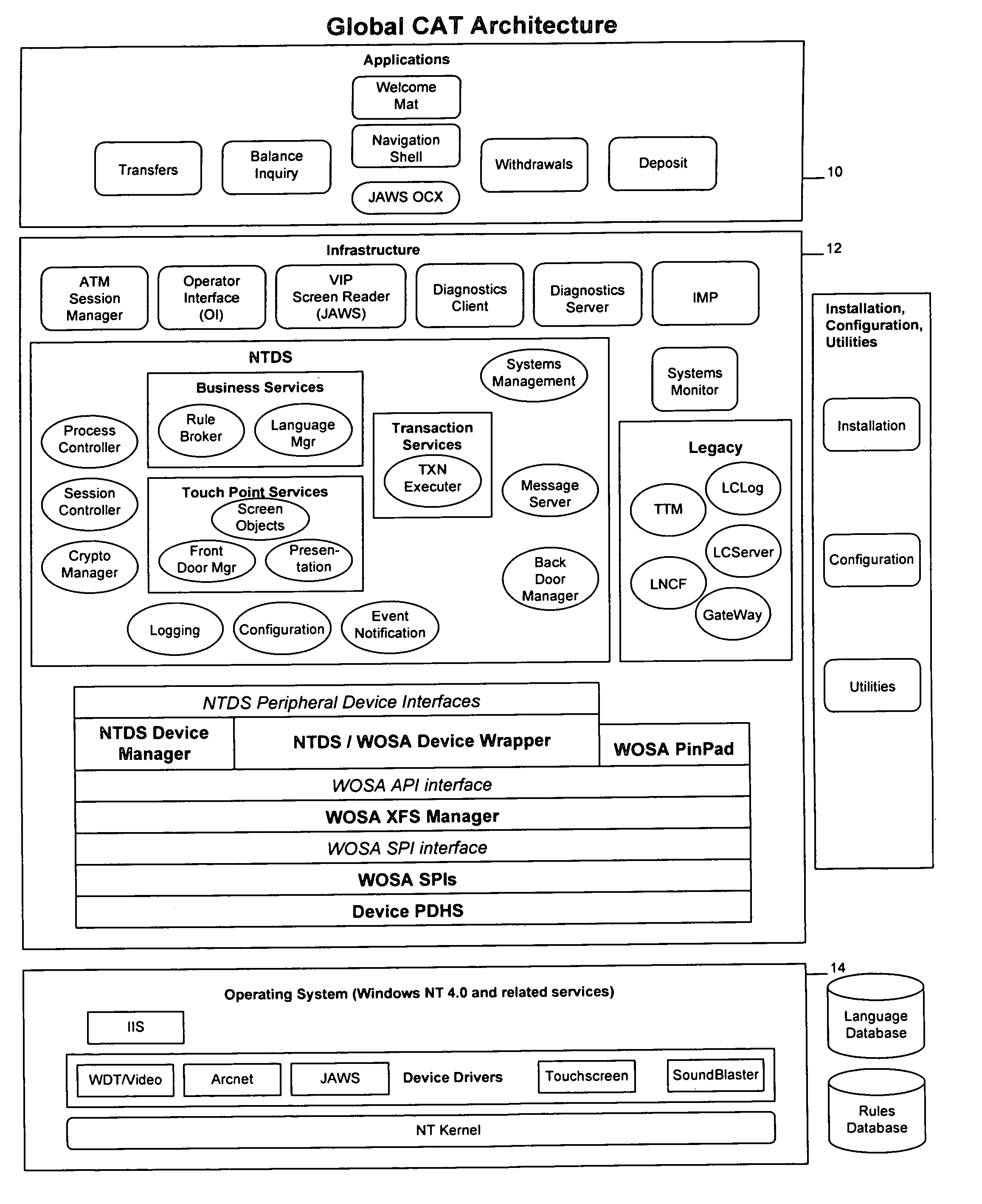

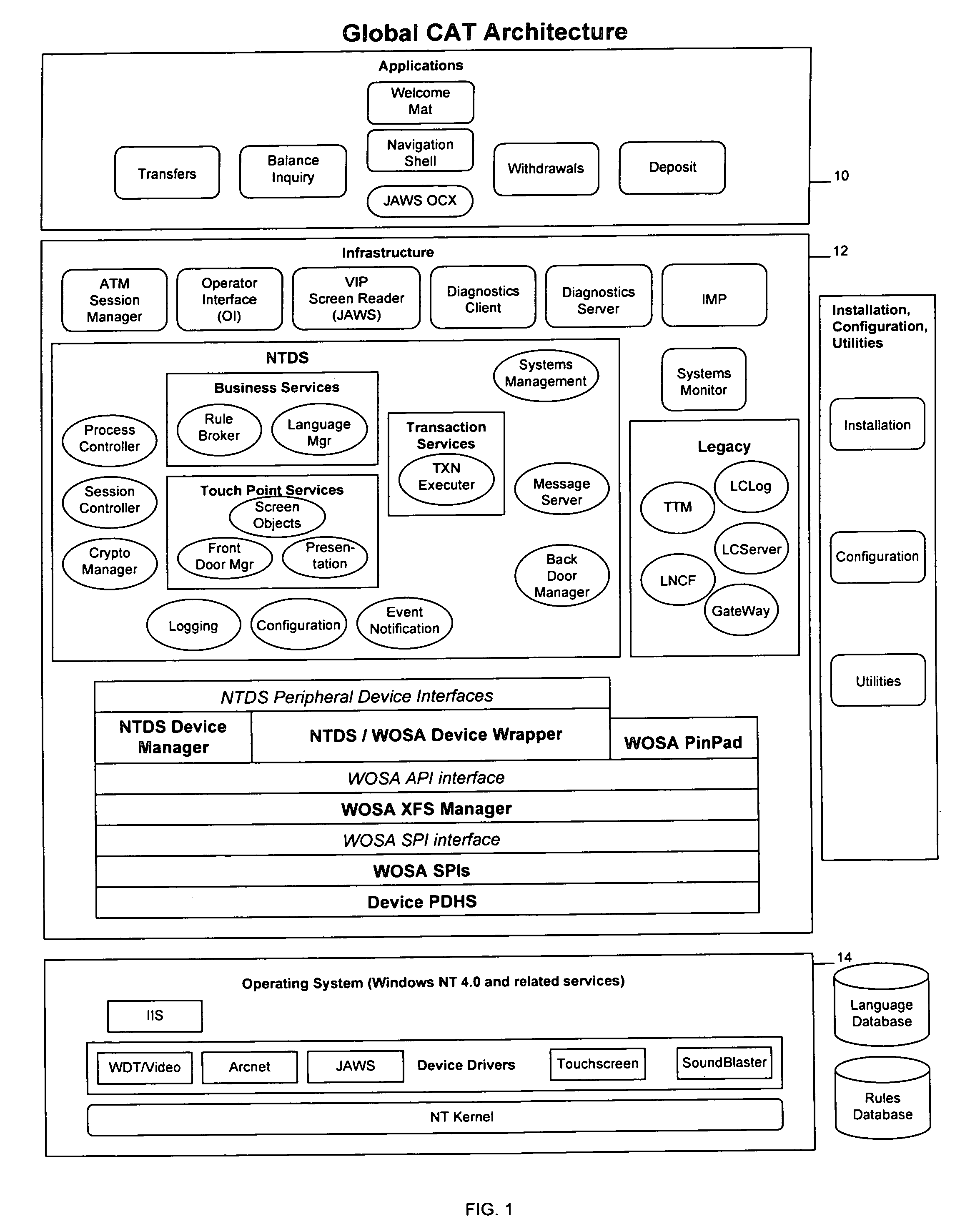

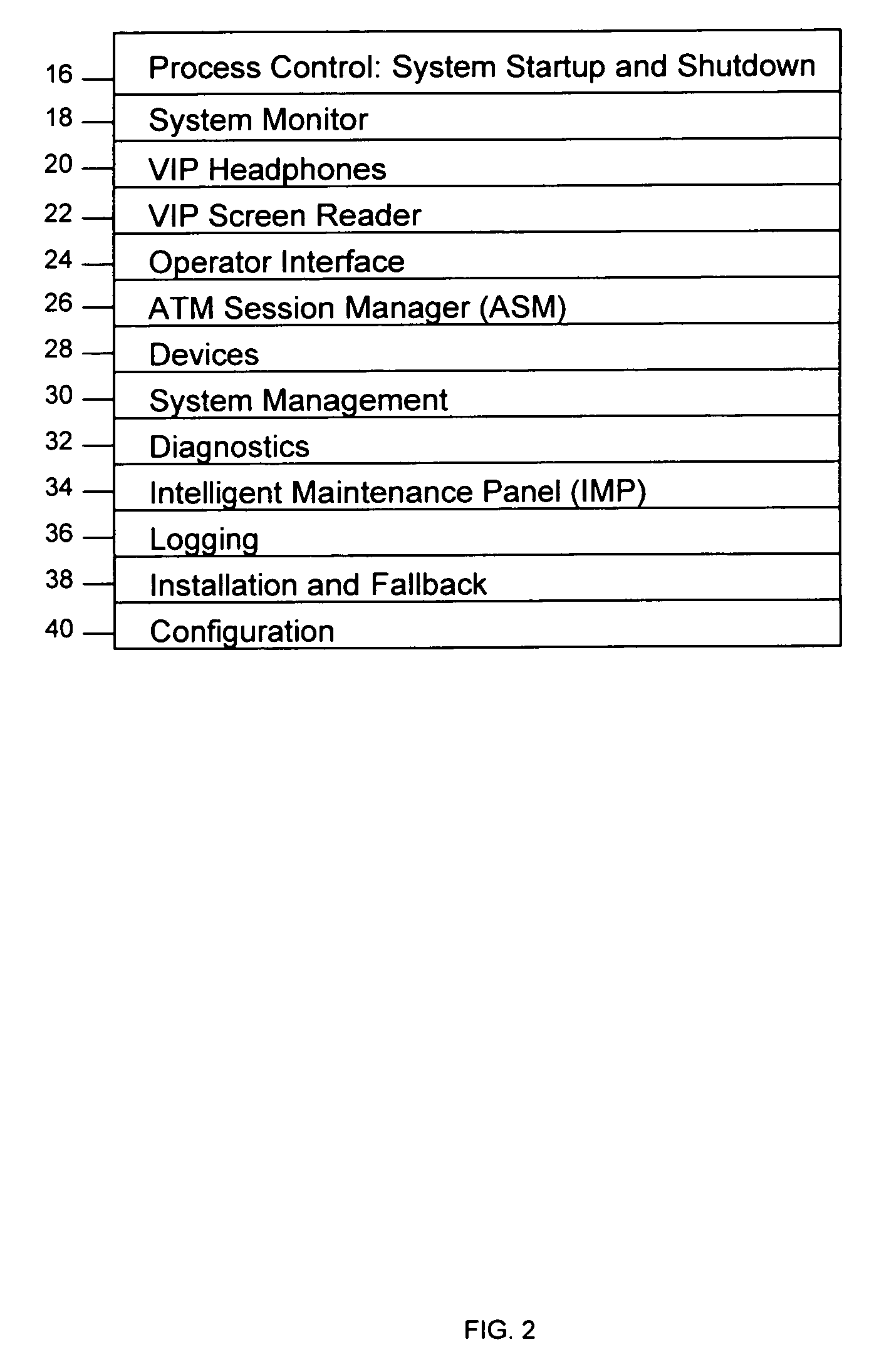

A method and system for providing global self-service transaction terminals or automatic teller machines (ATMs) affords worldwide web content to ATM customers, centralized management for ATM operators, and supports local and remote administration for ATM field service personnel. The system includes multiple ATMs coupled over a network to a host, and the ATMs are provided with a touch screen interface and an interface for visually impaired persons. The ATMs enable both local and remote administration of ATM operations by bank personnel and an integrated network control. The ATMs are web-enabled, and ATM communications are performed over a communications network.

Owner:CITICORP CREDIT SERVICES INC (USA)

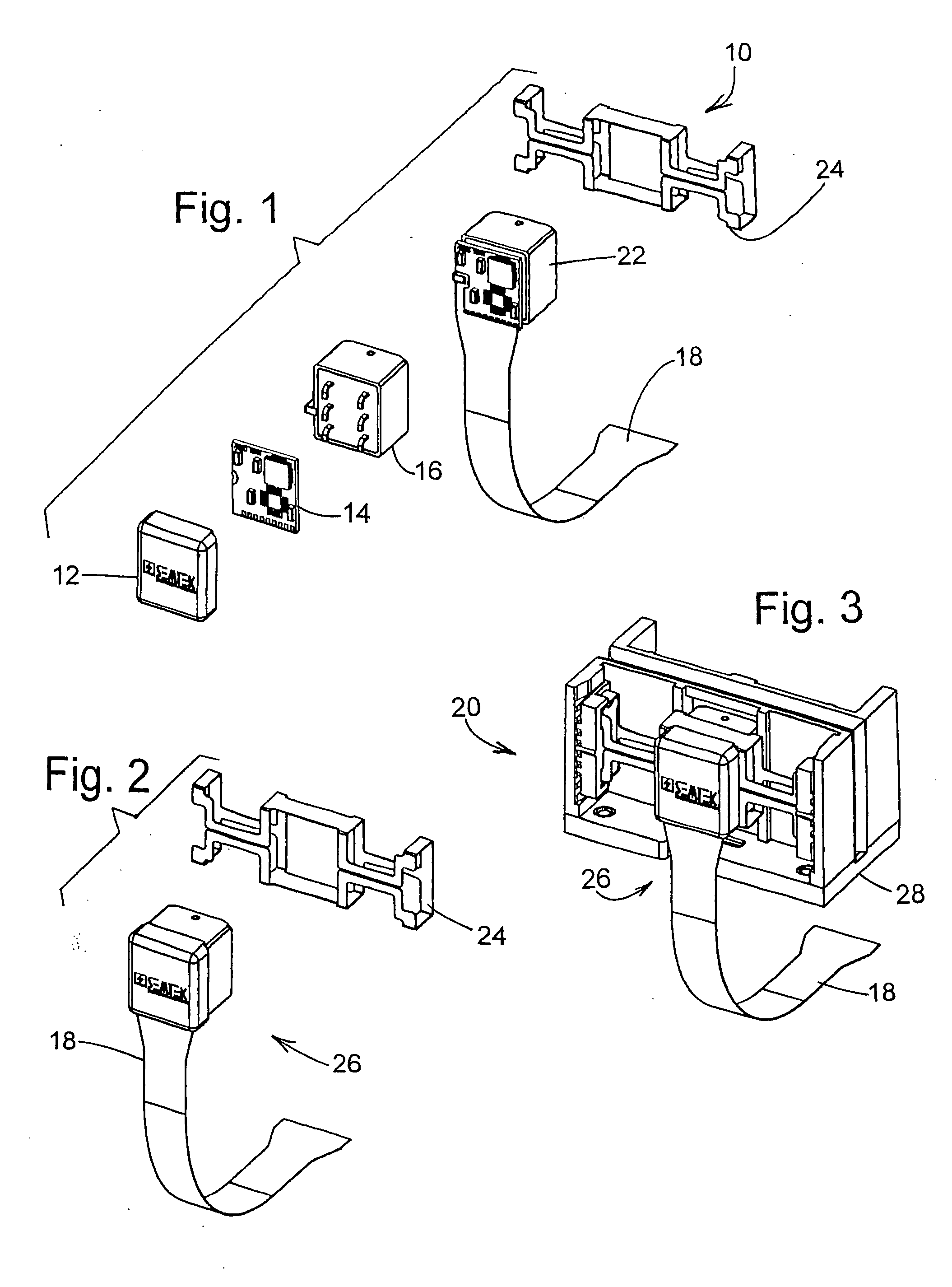

Method and system for secured transactions

InactiveUS20070276765A1Improve securityEasy to upgradeAcutation objectsFinancePlaintextBatch processing

Owner:SEMTEK INNOVATIVE SOLUTIONS

Automated banking machine component authentication system and method

ActiveUS7121460B1Increased resistenceAvoid modificationComplete banking machinesAcutation objectsComputer hardwareAuthentication system

An automated banking machine is provided which includes a first component and a second component. The first component is operative generate a first hash of a first identity data and a public key associated with the second component. The first component is operative to encrypt a randomly generated secret key using the public key associated with the second component. The second component is operative to receive at least one message from the first component which includes the encrypted secret key and the first hash. The second component is operative to decrypt the secret key with a private key that corresponds to the public key. The second component is operative to permit information associated with a transaction function to be communicated between the first and second components which is encrypted with the secret key when the first hash is determined by the second component to correspond to the first component.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

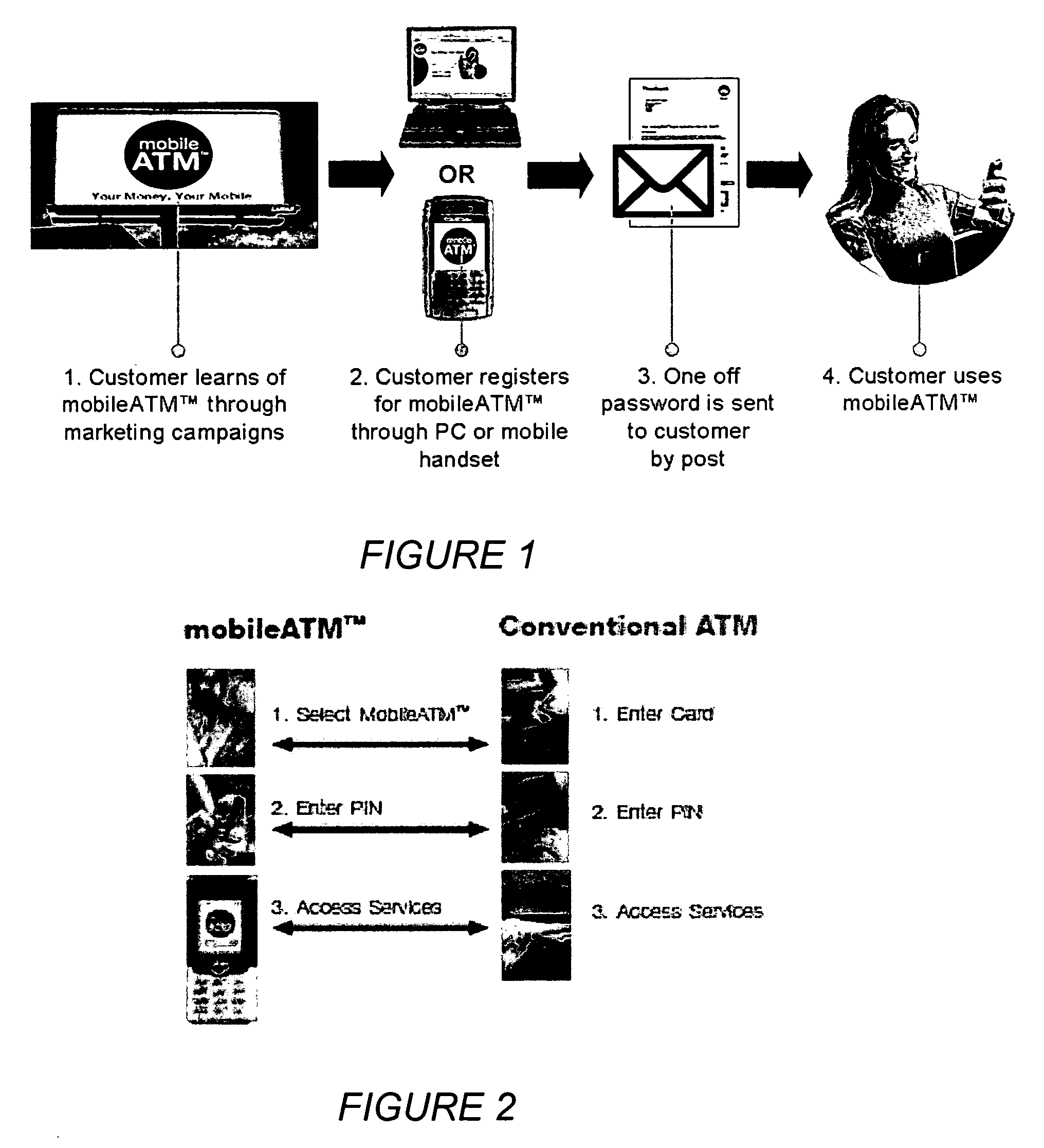

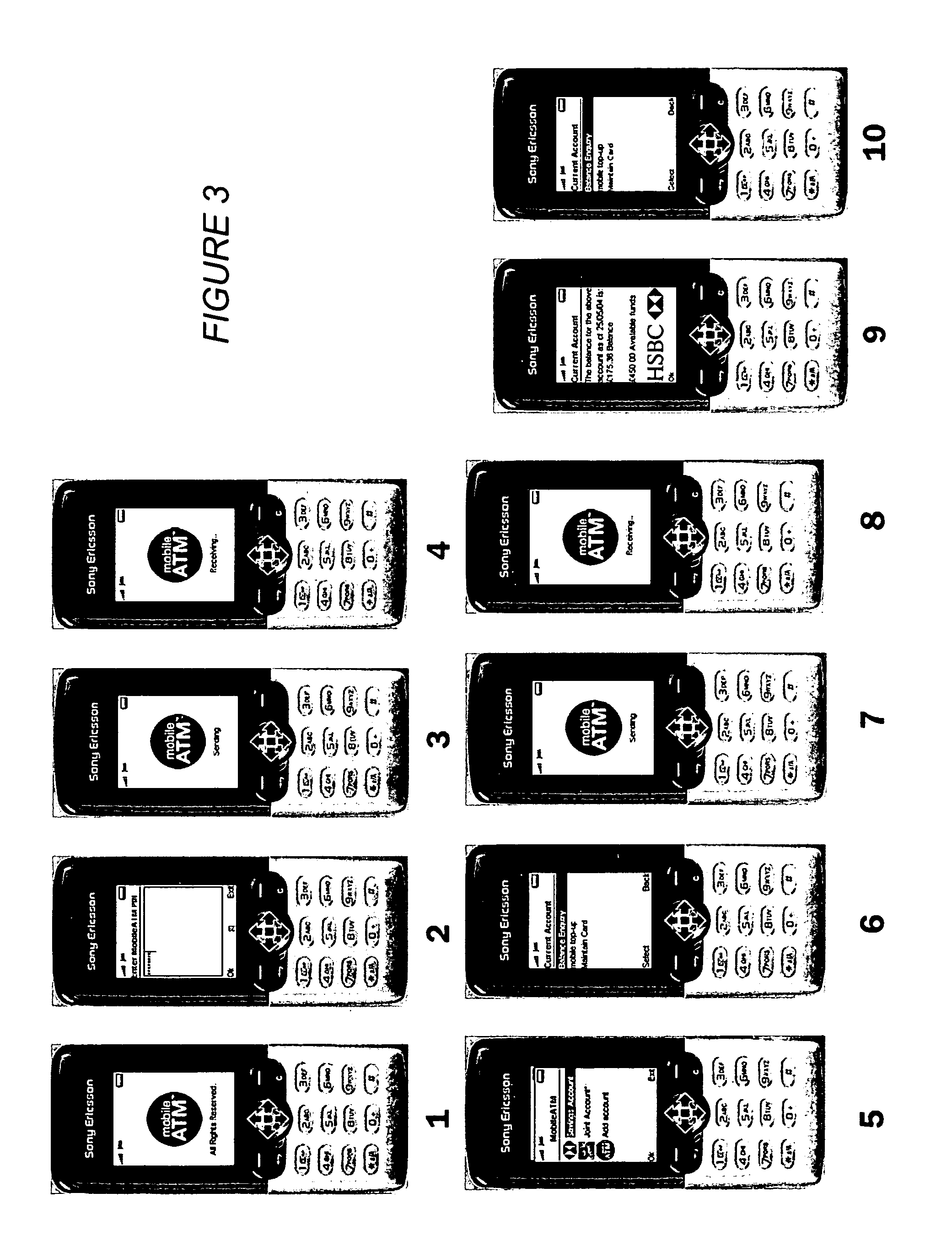

Electronic system for provision of banking services

ActiveUS20060136334A1Increased positional freedomWithout compromising securityComplete banking machinesFinanceElectronic systemsMobile telephony

An electronic system providing banking services, comprises a server having a first interface for communication with user mobile telephony devices over a mobile telephone network; and a second interface for communication with an intermediary acting as a gateway to banking records of multiple banking organisations. The first interface is adapted to allow at least balance enquiry requests to be submitted to one of the multiple banking organisations by means of the intermediary and to provide at least balance enquiry replies for display on the user mobile telephony device. The invention provides the functions of the high street ATM using the mobile phone environment.

Owner:FISERV

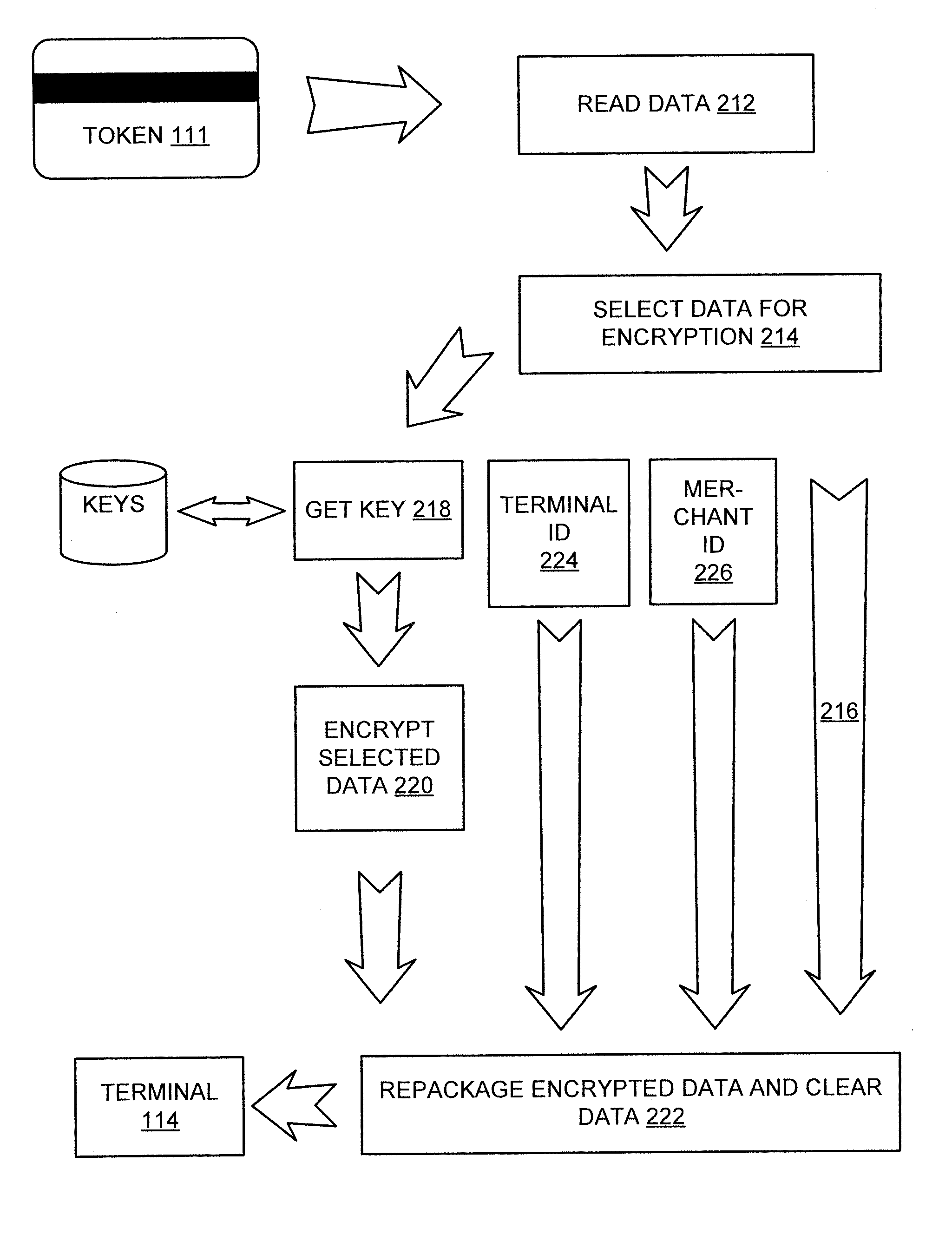

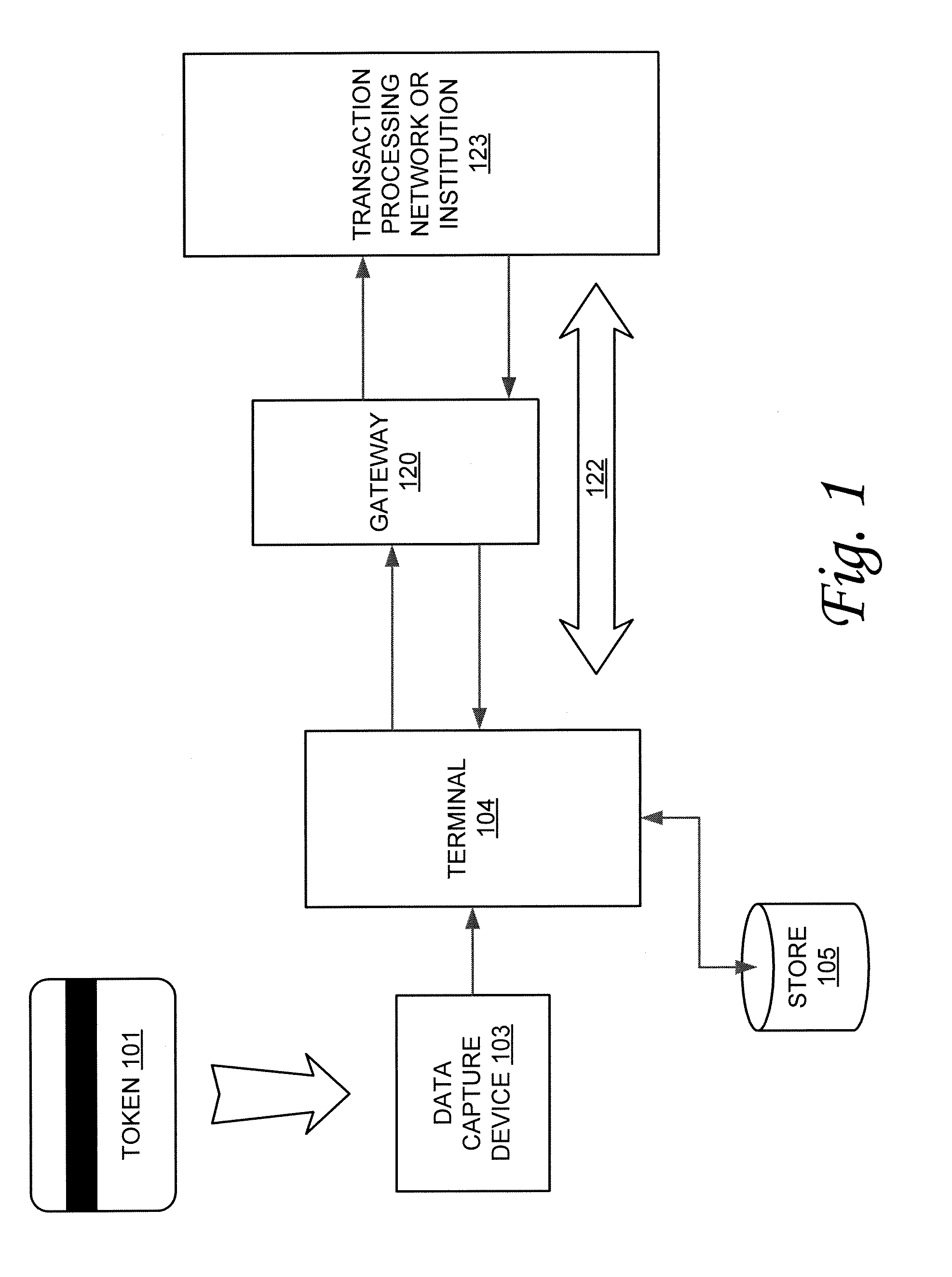

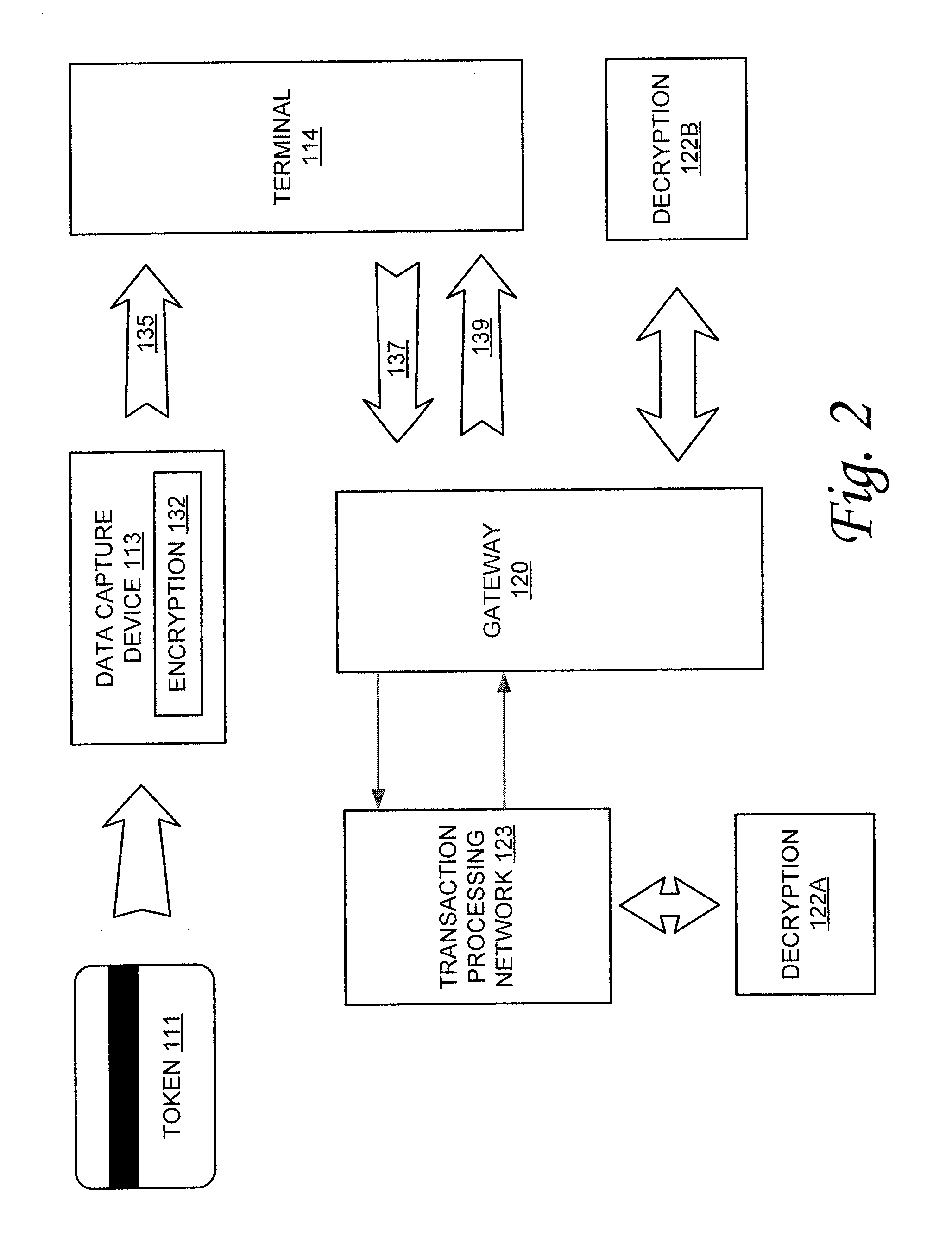

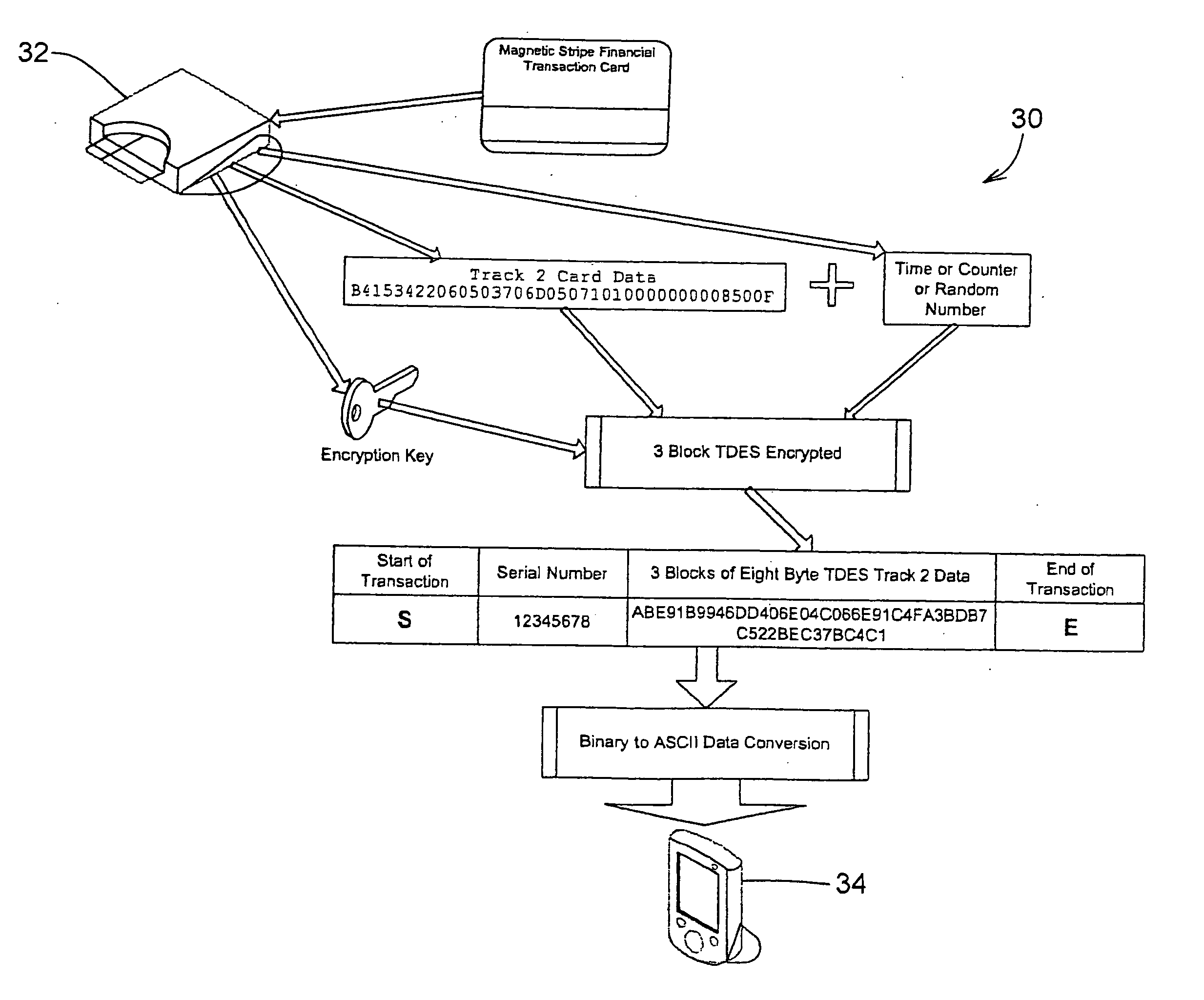

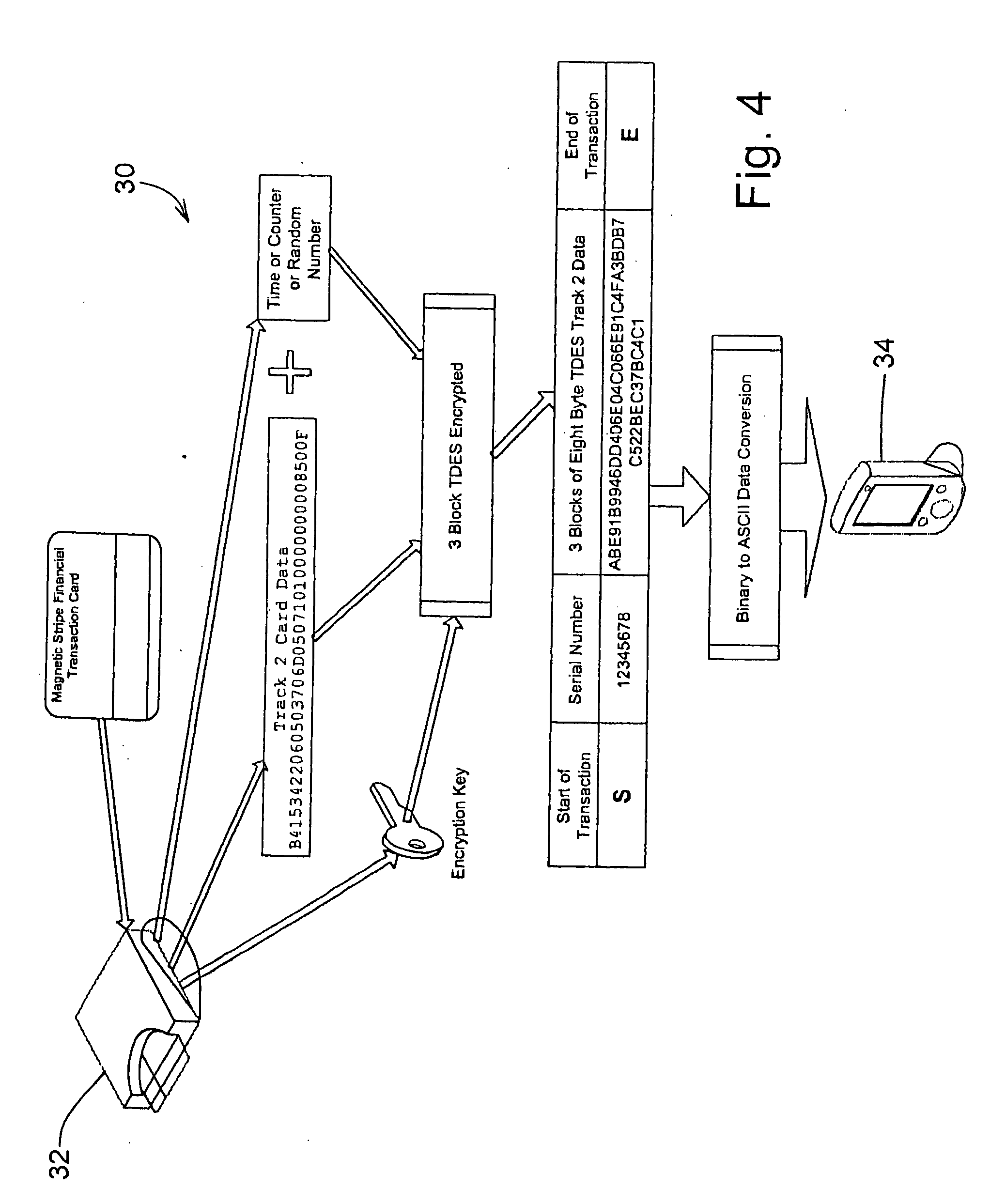

Transparently securing data for transmission on financial networks

ActiveUS20060049256A1Easy to operateIncrease powerAcutation objectsFinanceInformation processingSoftware system

A secure magnetic stripe card stripe reader (MSR) module and software system capable of encrypting the magnetic stripe data to CPI, SDP and CISP standards for use in point of sale (POS) and other applications requiring data security using non secure networks and computing devices. Additionally, when incorporated within an attachment for conventional personal digital assistant (PDA) or cell phone or stationary terminal, provides encrypted data from the magnetic head assembly providing compliance with Federal Information Processing Standards Publication Series FIPS 140 covering security and tampering standards. Moreover, this module and software system includes the capability of providing secure POS transactions to legacy transaction processing systems and POS terminals transparently to the existing infrastructure. Furthermore, this module and software system includes the capability of transparently providing detection of fraudulently copied magnetic stripe cards.

Owner:VERIFONE INC

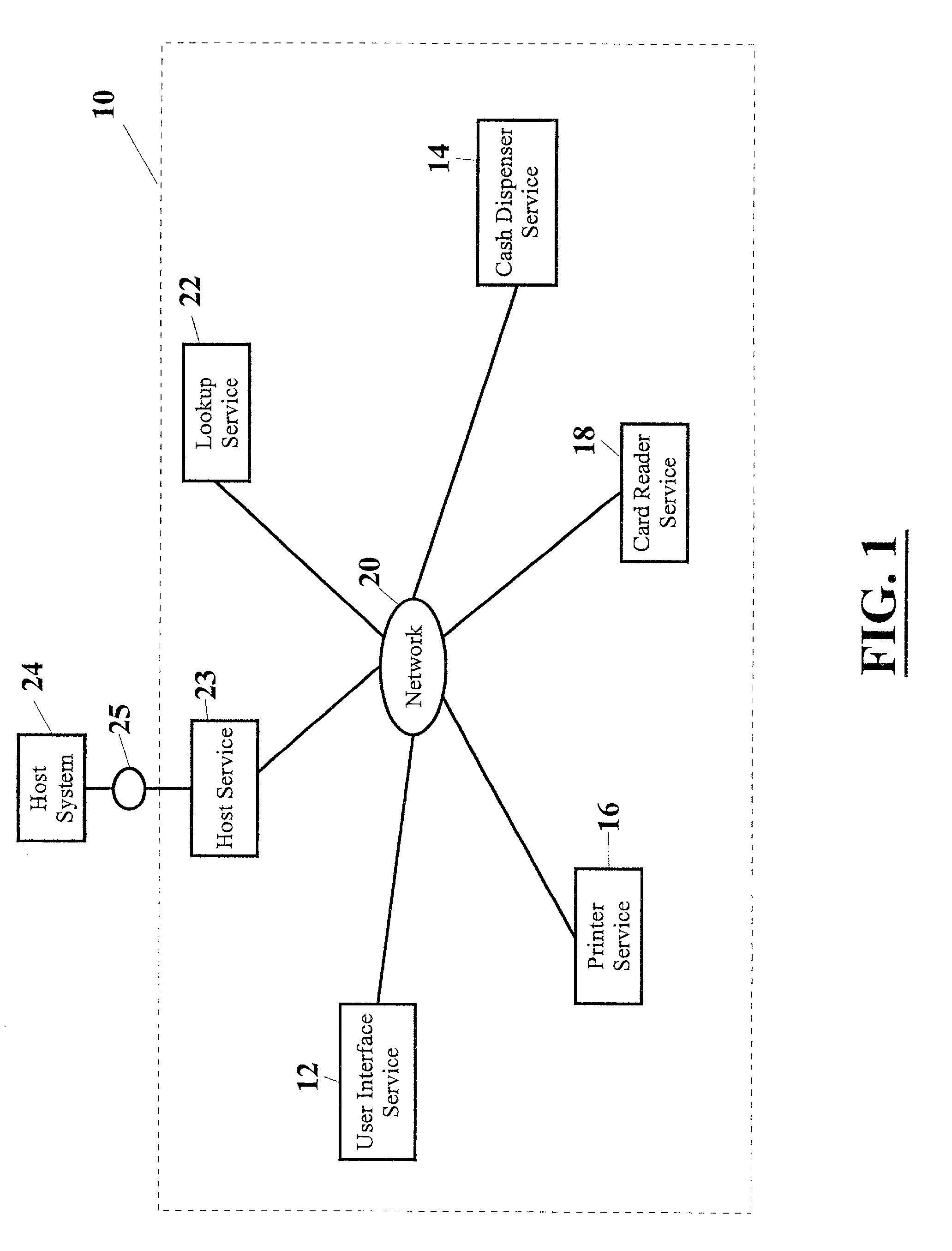

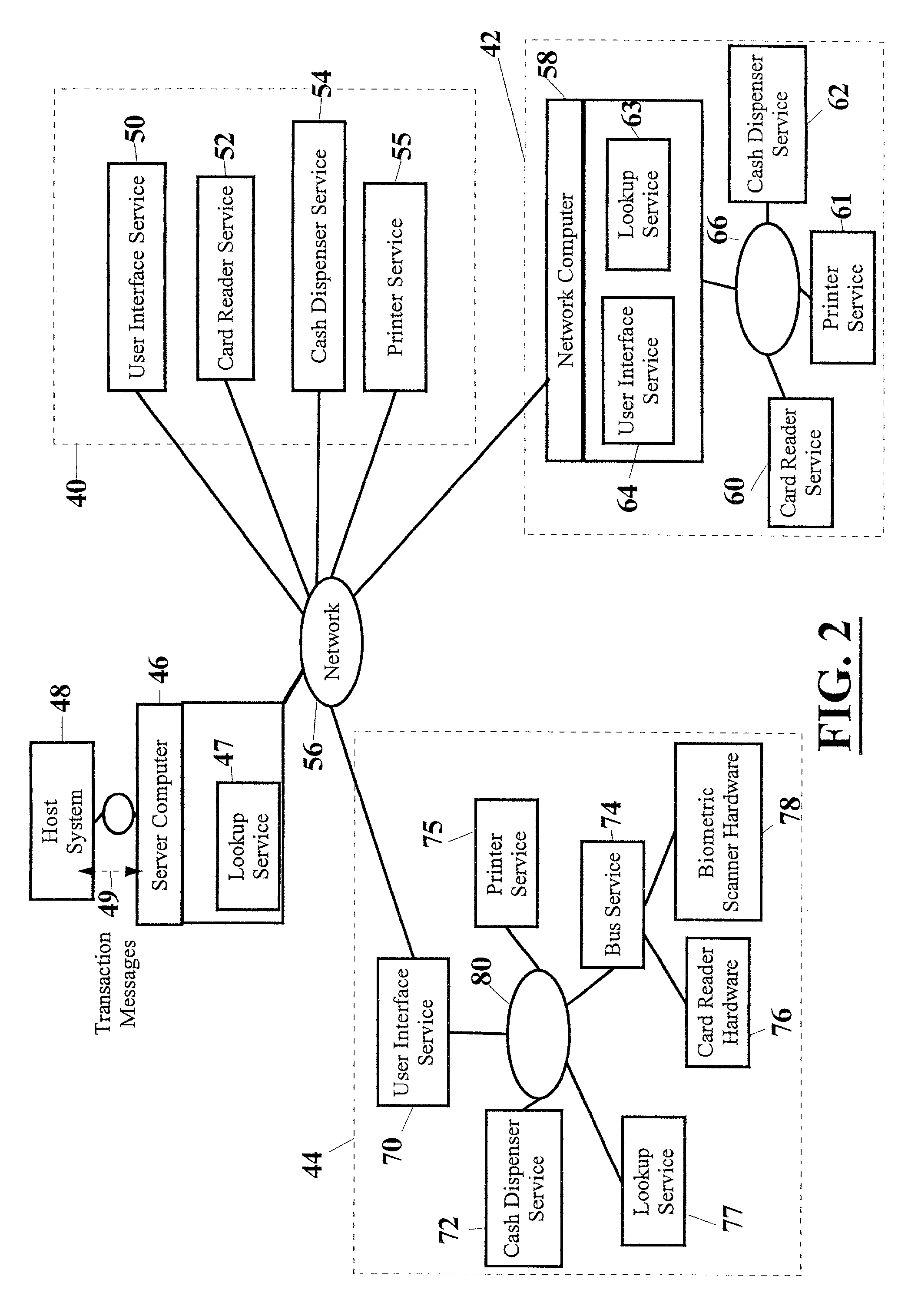

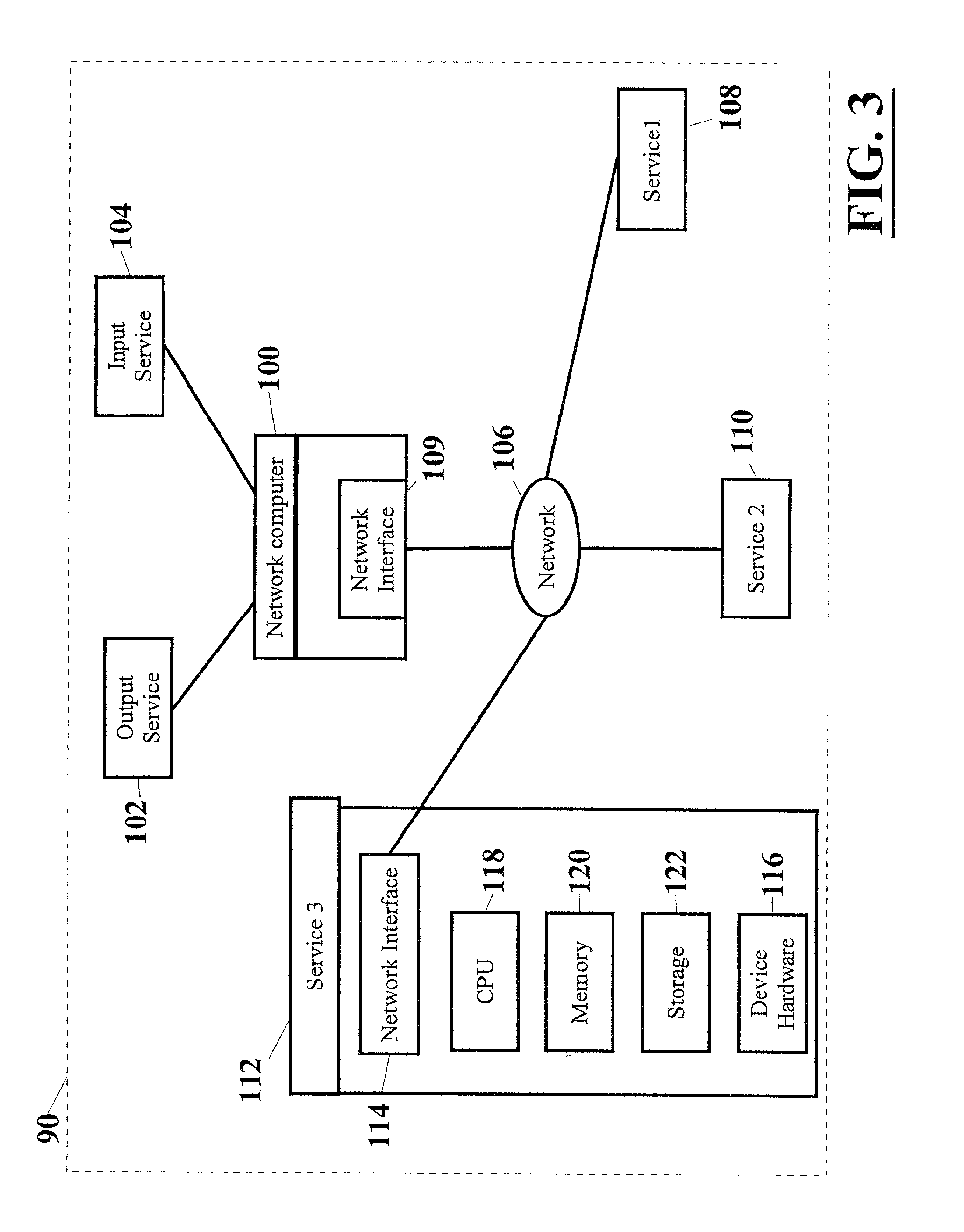

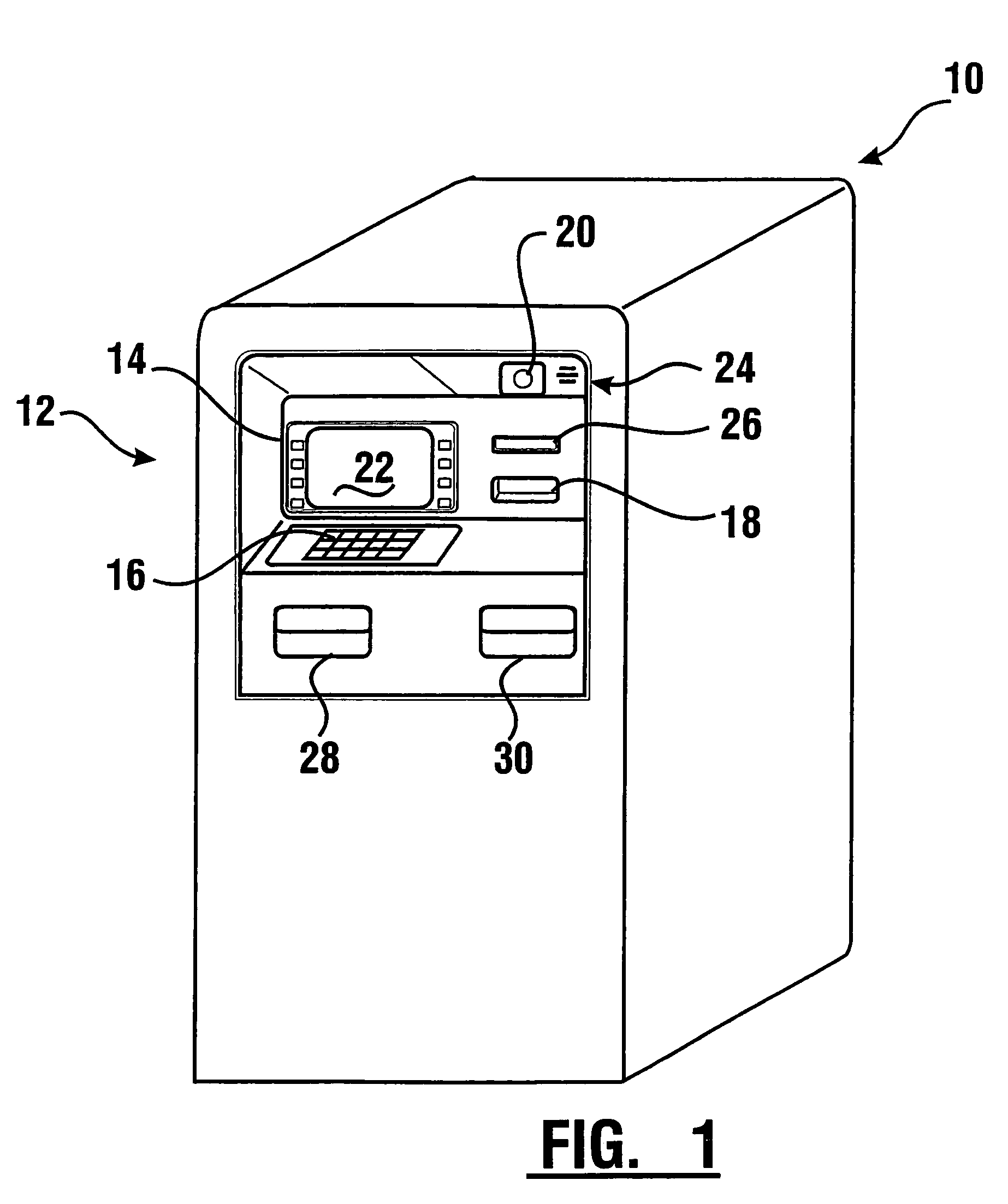

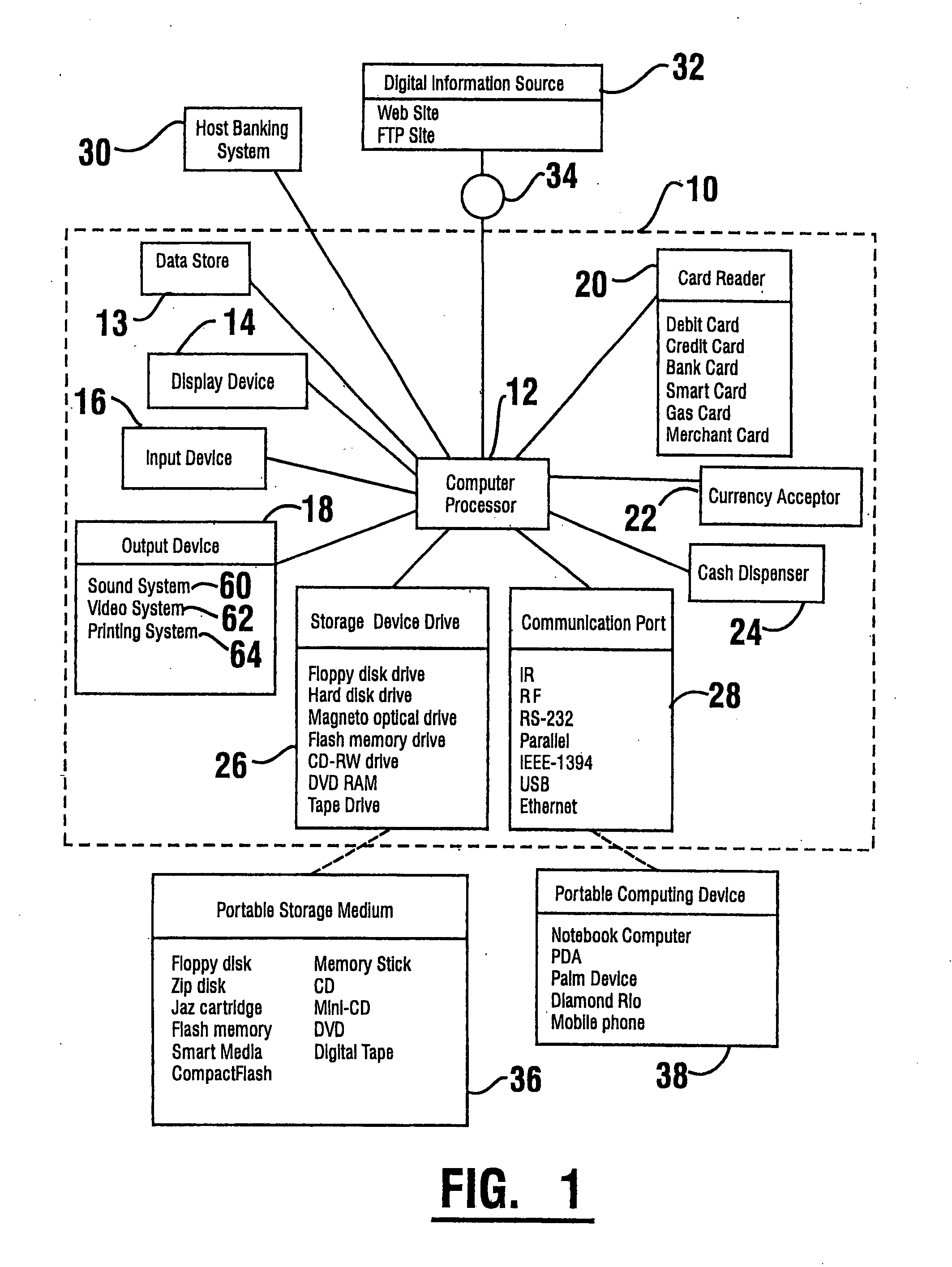

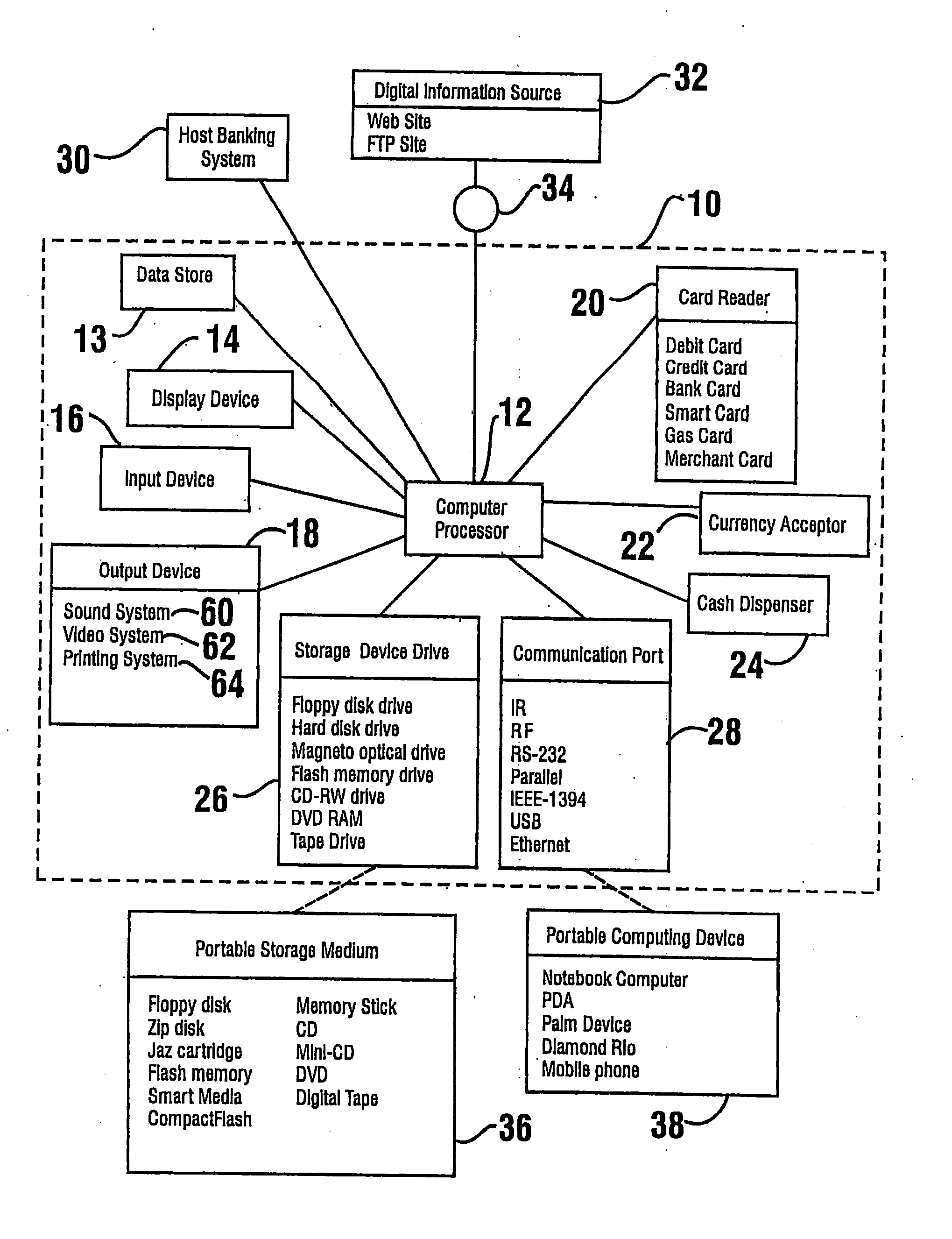

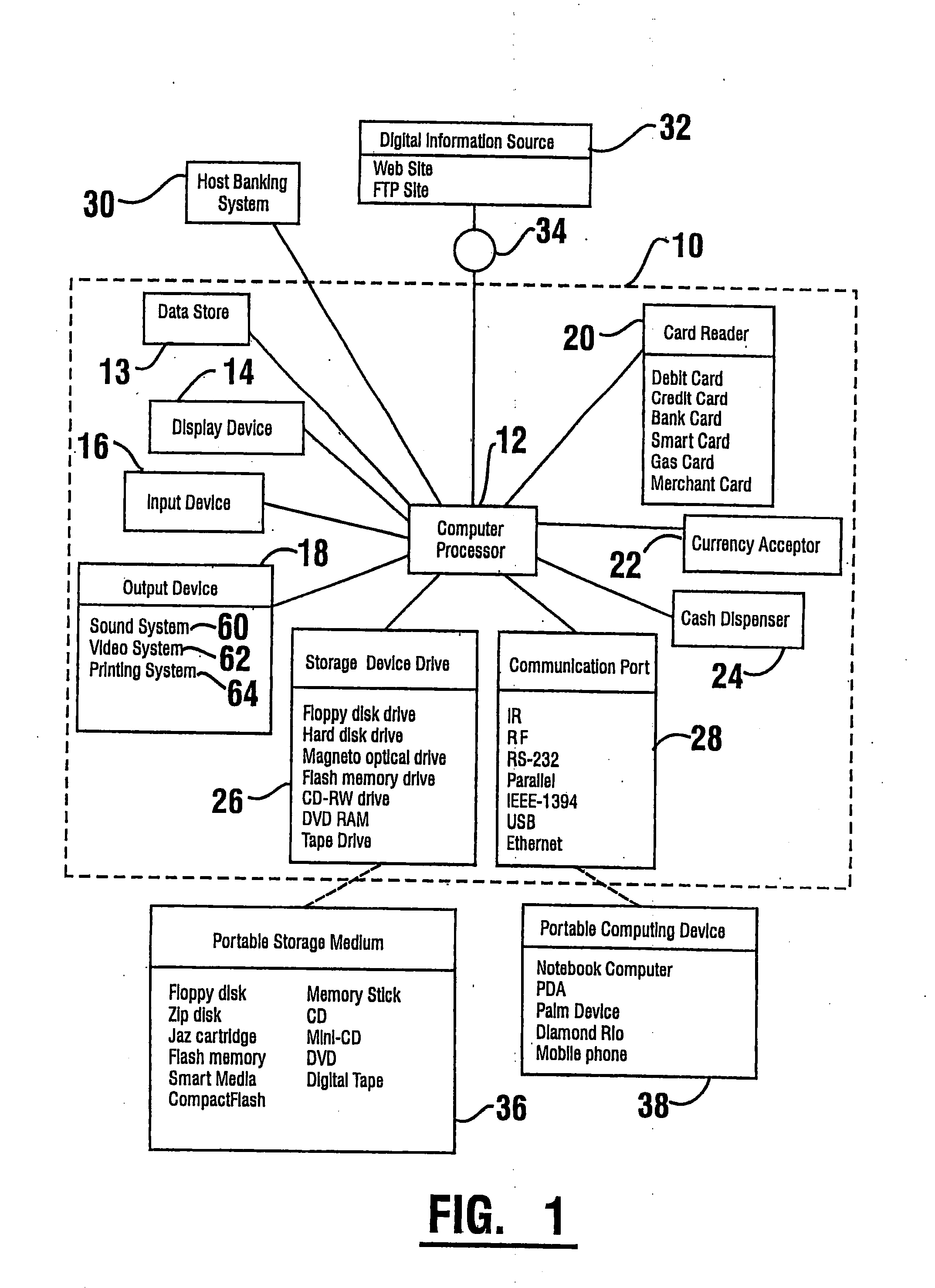

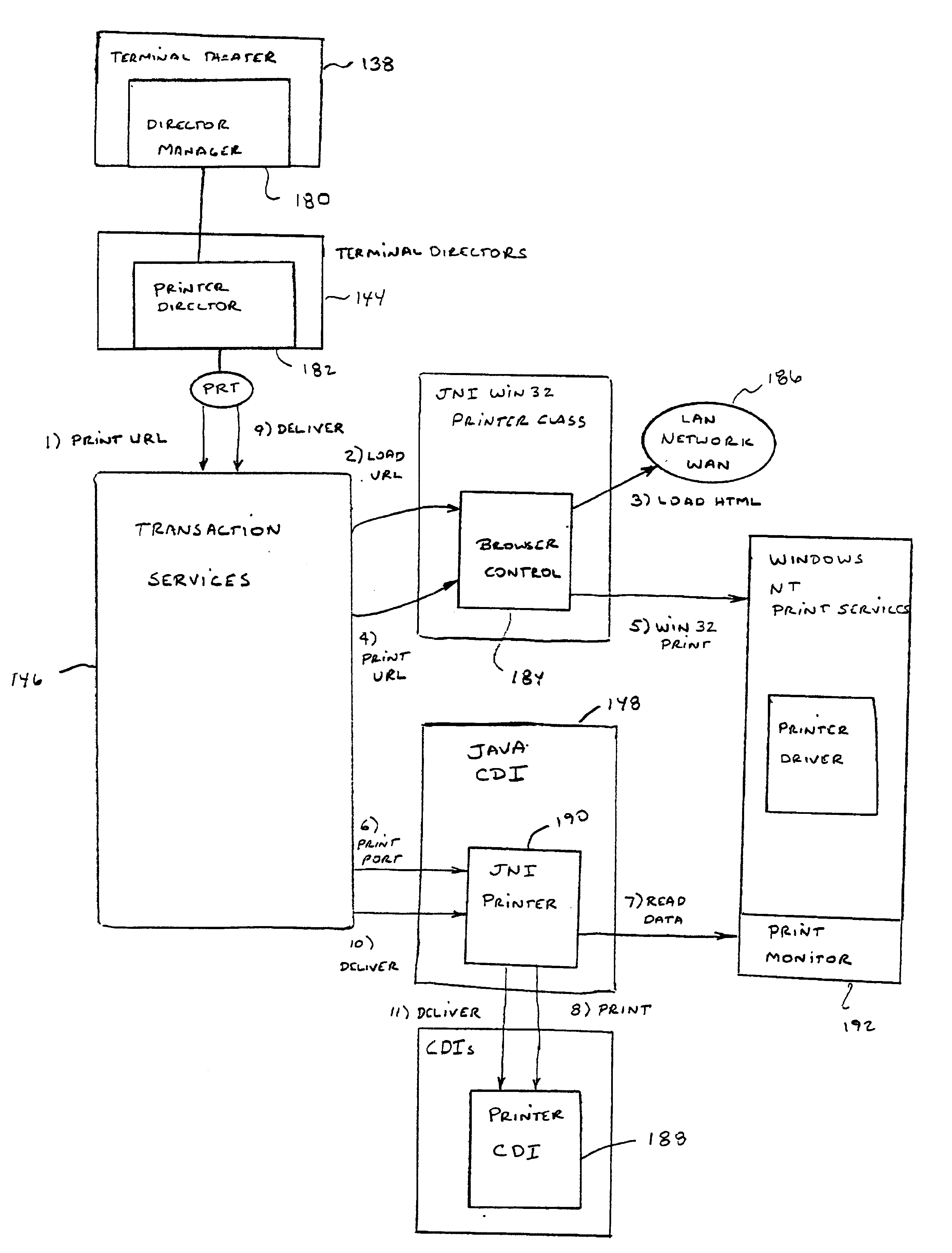

Automated transaction machine and method

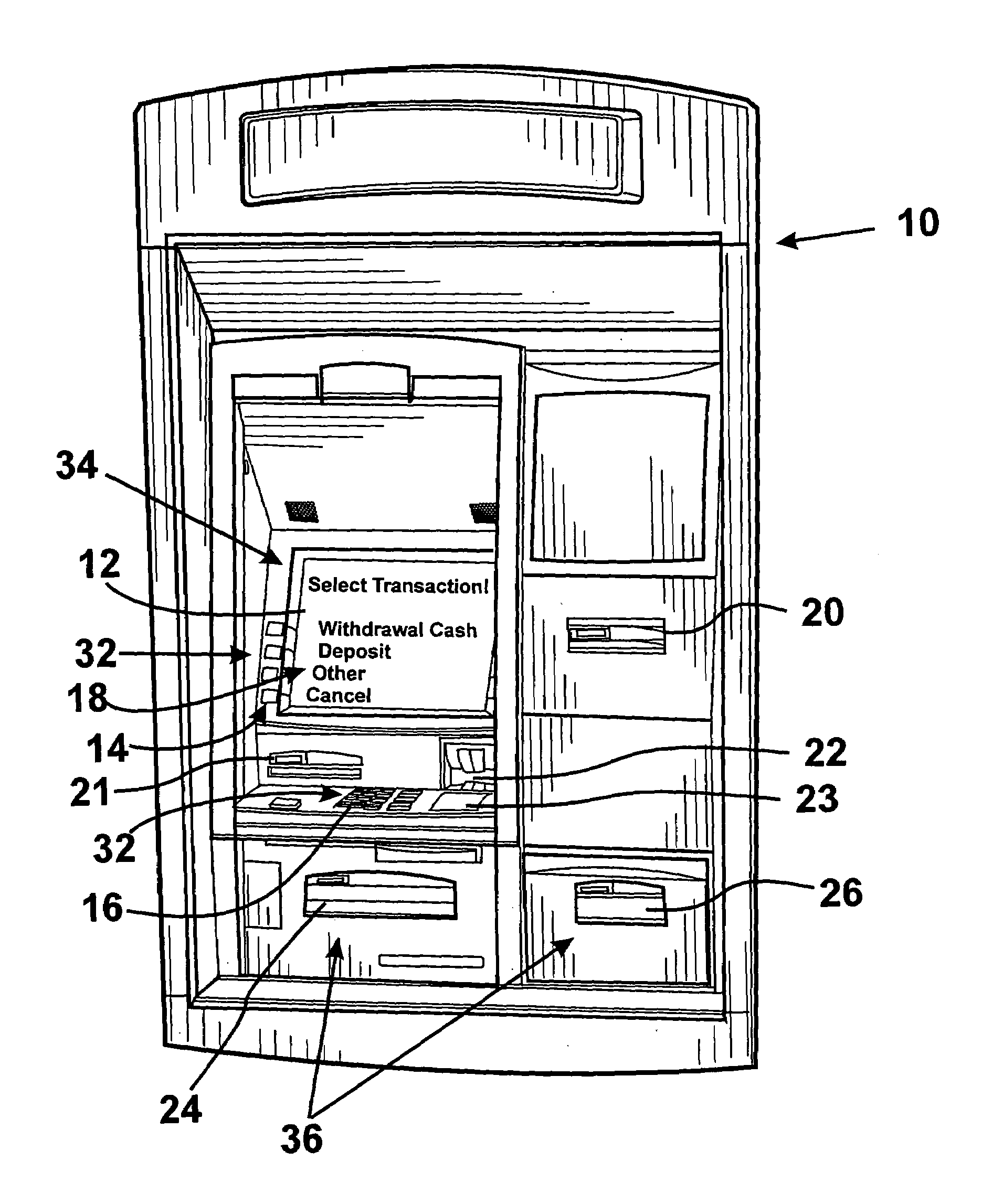

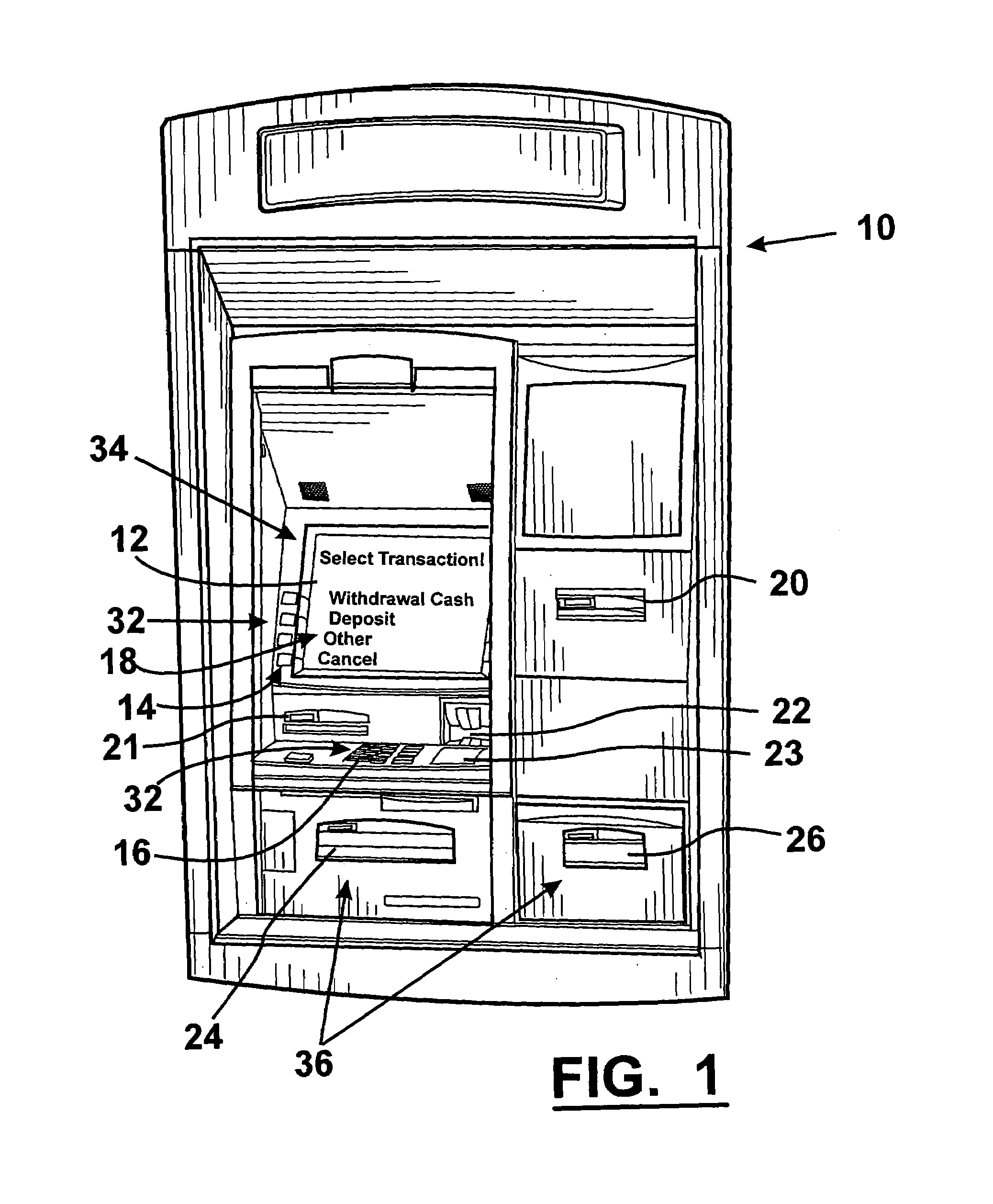

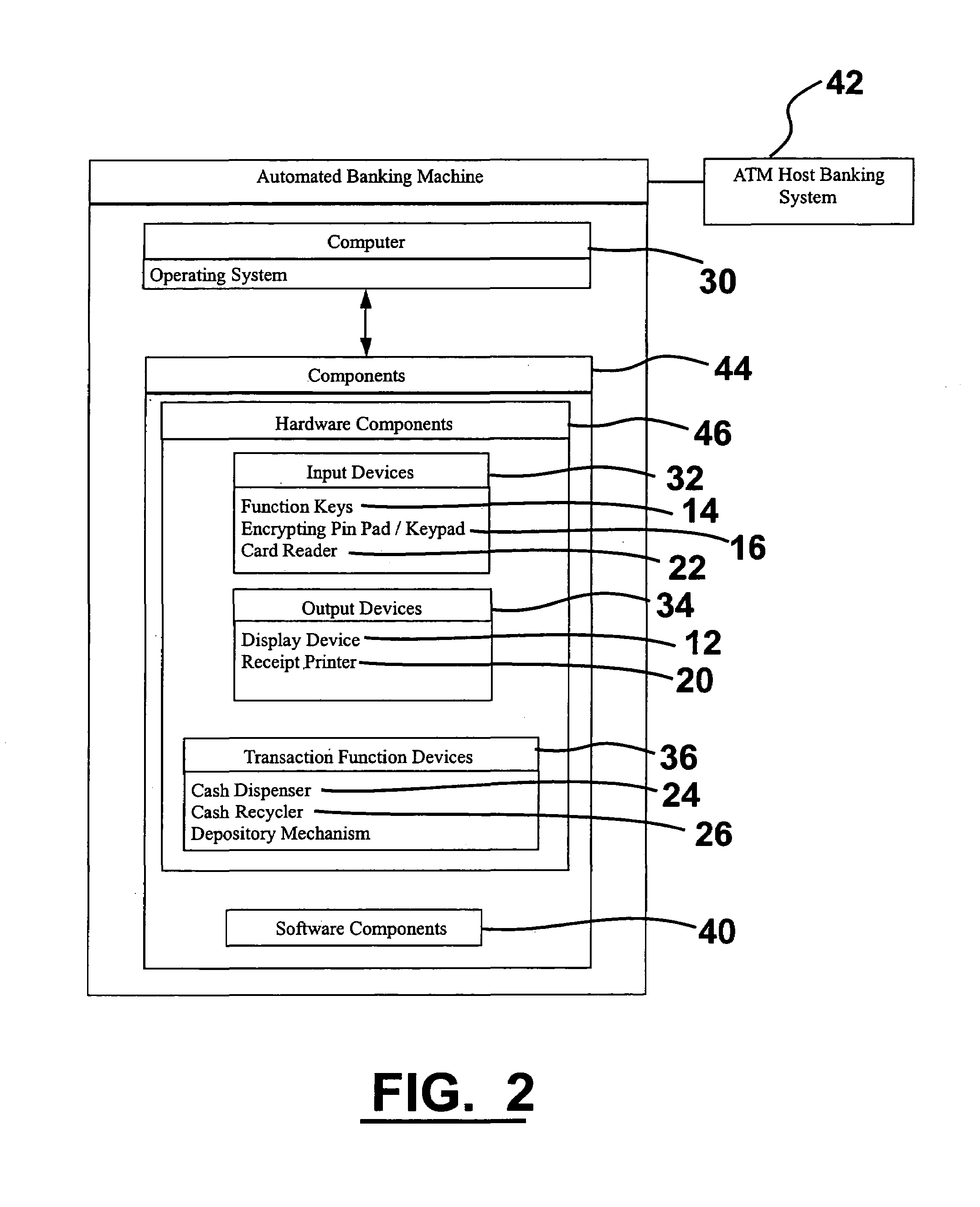

InactiveUS20010014881A1Firmly connectedExtension of timeComplete banking machinesFinanceTransaction serviceCard reader

A system for connecting transaction services to an ATM (10, 500) that includes a network (20). A user interface service (12) and a lookup service (22) are in operative connection with the network. Transaction services such as a printer service (16), card reader service (18), and cash dispenser service (14) are also in operative connection with the network. These transaction services are operative to register with the lookup service and to upload a service proxy to the lookup service. The user interface service is operative to locate transaction services on the network by invoking a remote lookup method on the lookup service. The lookup service is operative to return service proxies that match the type of service that is required. The user interface service is further operative to invoke methods of the service proxies that remotely control the functionality of the transaction services on the network. The user interface service is further operative to register events with the service proxies for notification when certain events on the services occur.

Owner:DIEBOLD NIXDORF

Method and system of evaluating checks deposited into a cash dispensing automated banking machine

InactiveUS7377425B1Improve reliabilityReduce riskComplete banking machinesFinanceTransaction dataCheque

An automated banking machine system and method includes ATMs which accept checks and dispense cash to users. The ATMs are operated to acquire image and magnetic data from deposited checks to determine the genuineness of checks and the authority of a user to receive cash for such checks. Cash may be dispensed to the user from the ATM in exchange for the deposited check. The ATMs dispense cash responsive to communications with a transaction host. The transaction host provides transaction identifying data to the ATM. The ATM sends the transaction identifying data and check images to an image and transaction data server for processing.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

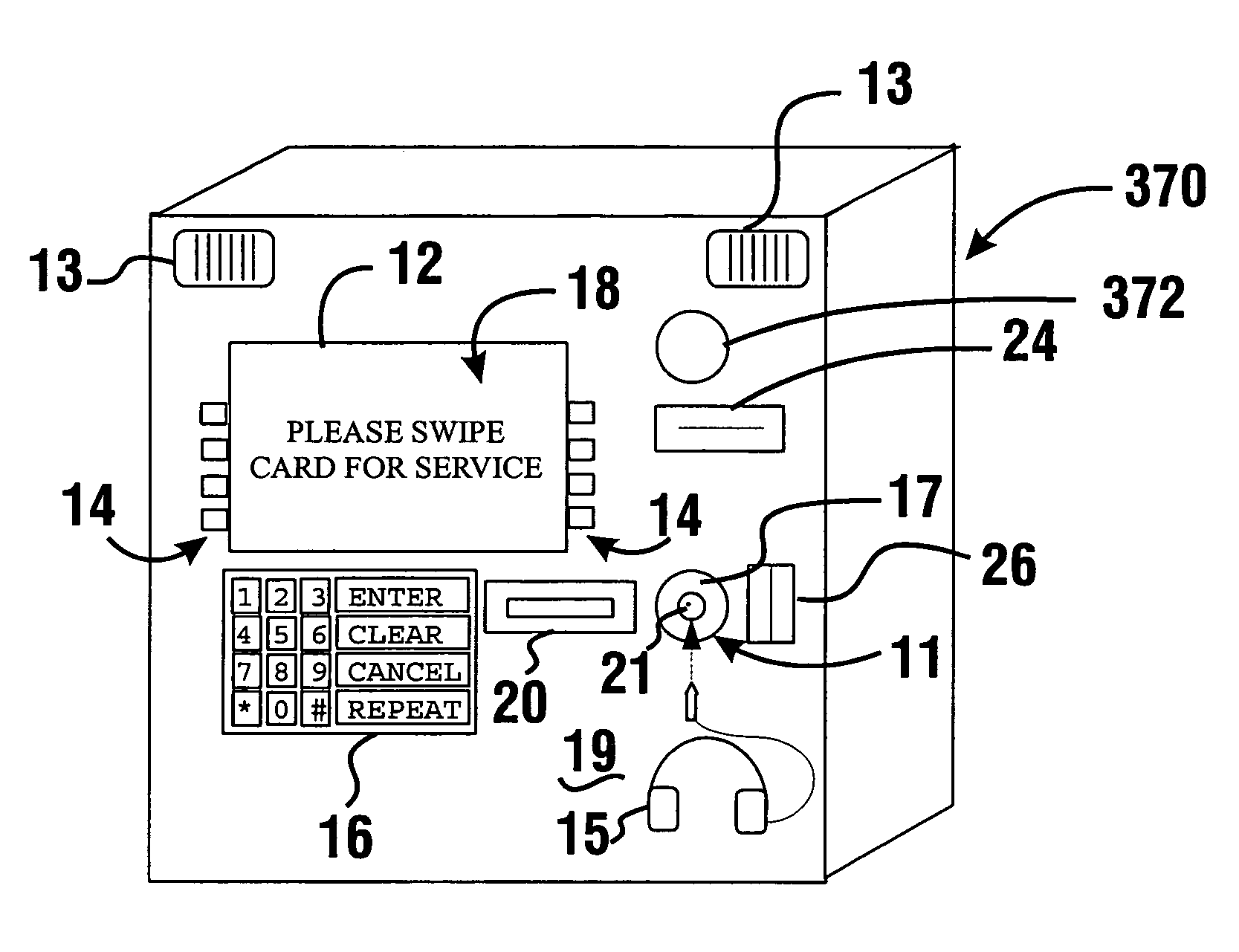

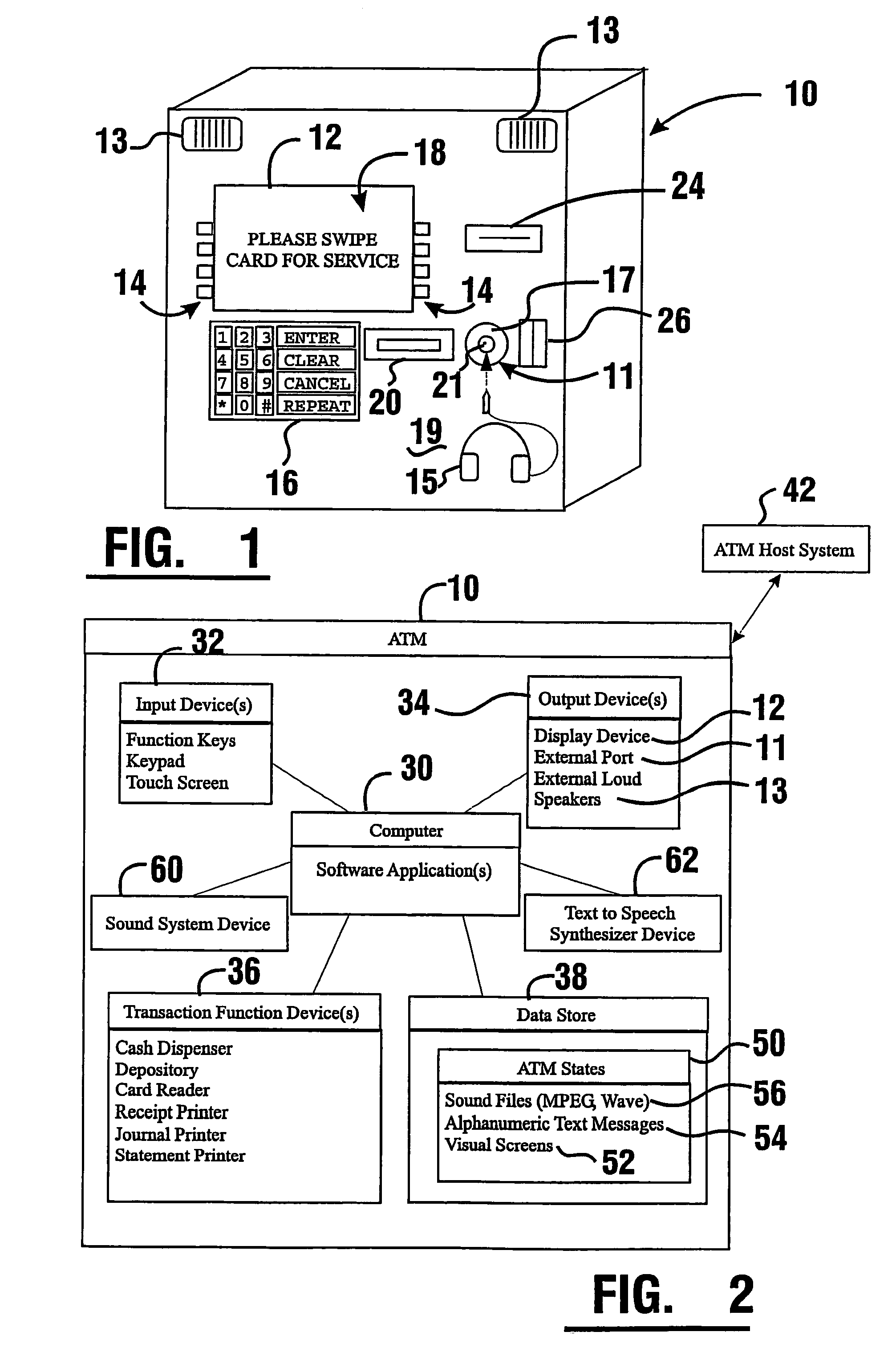

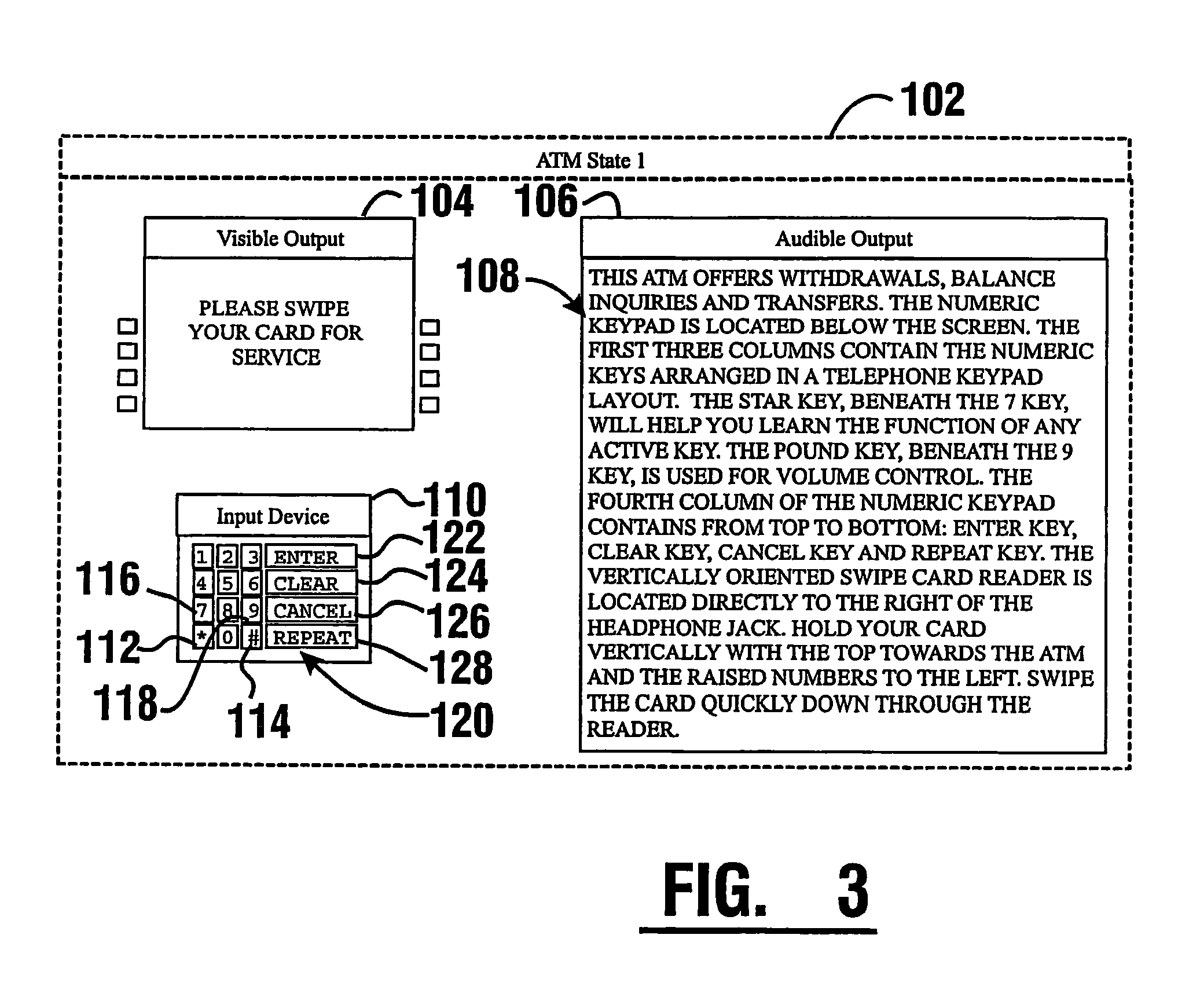

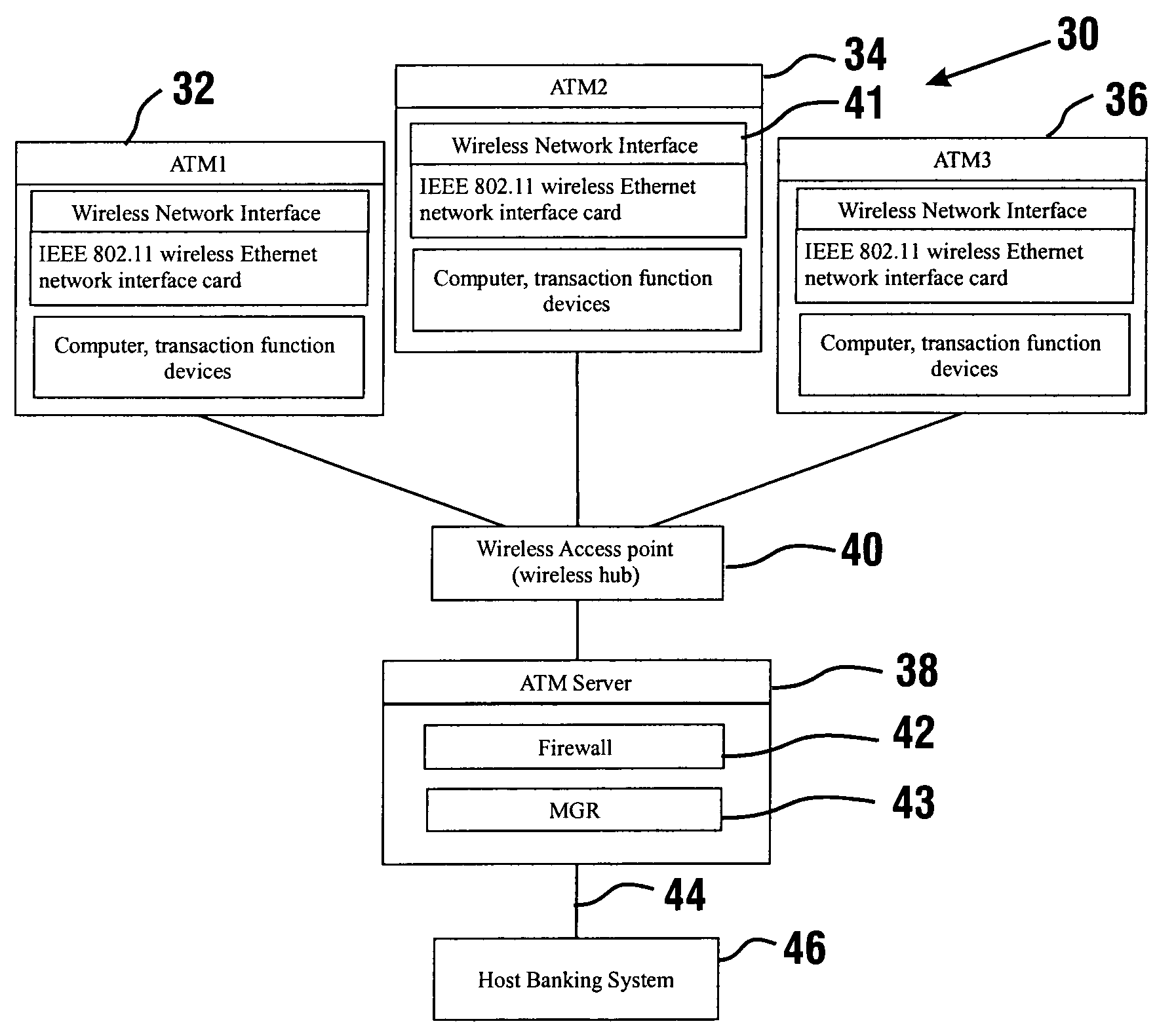

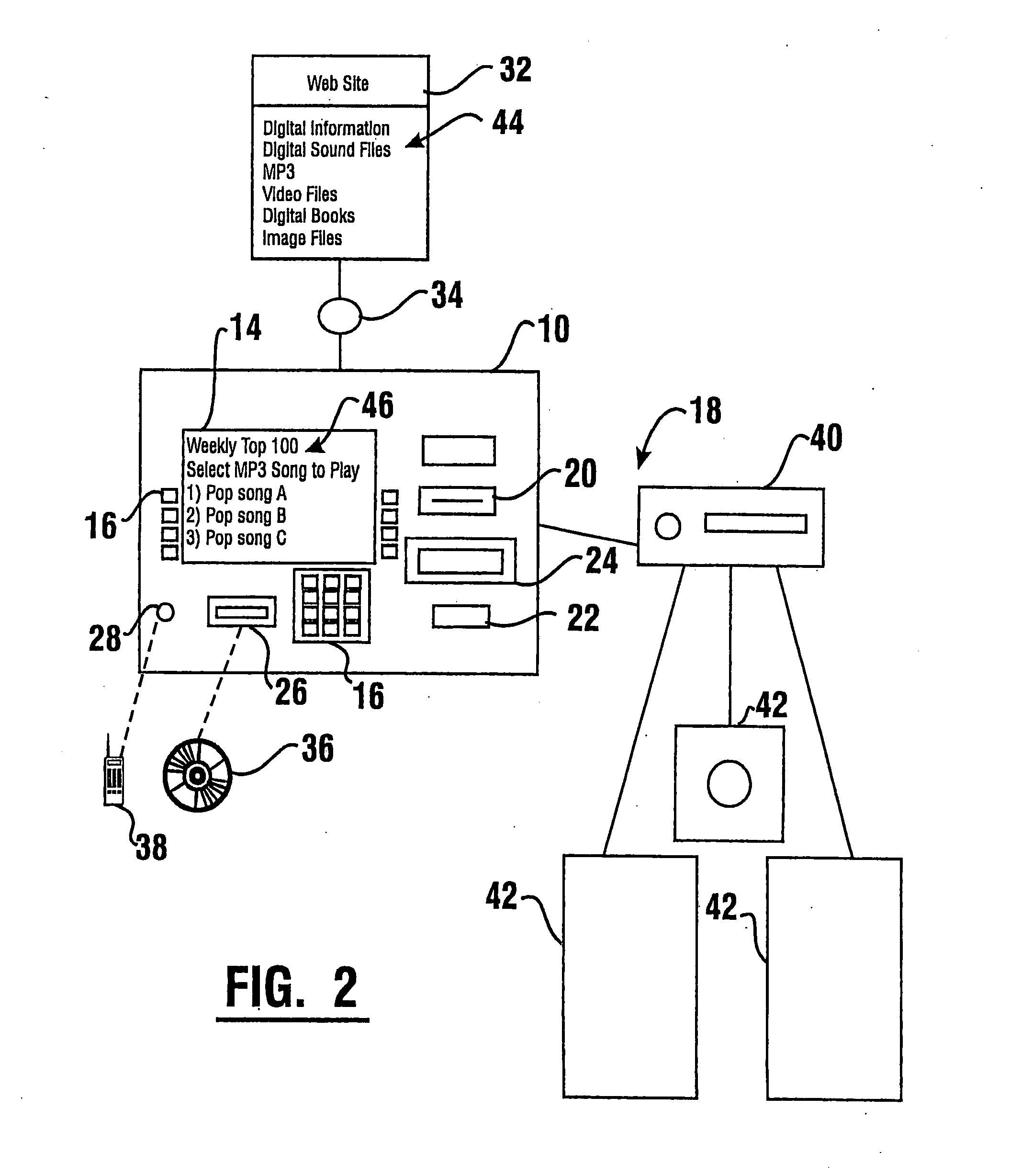

Cash dispensing automated banking machine user interface system and method

An automated banking machine is operative to enable users to operate the machine to carry out transactions such as the dispensing of cash. The exemplary machine provides audible instructions which are output through external loudspeakers, a headphone, or a handset. Rotation of a rotatable knob (372, 382) or other movable item causes the output of user selectable characters, transaction types and / or amounts corresponding to each respective position. The user selects the audible output produced in the current position of the knob for receipt by the machine as a transaction input by pressing on the knob. Characters and other selectable inputs corresponding to knob positions can be varied by the computer in the machine to reduce the risk of a criminal intercepting the user's inputs to the machine.

Owner:DIEBOLD NIXDORF

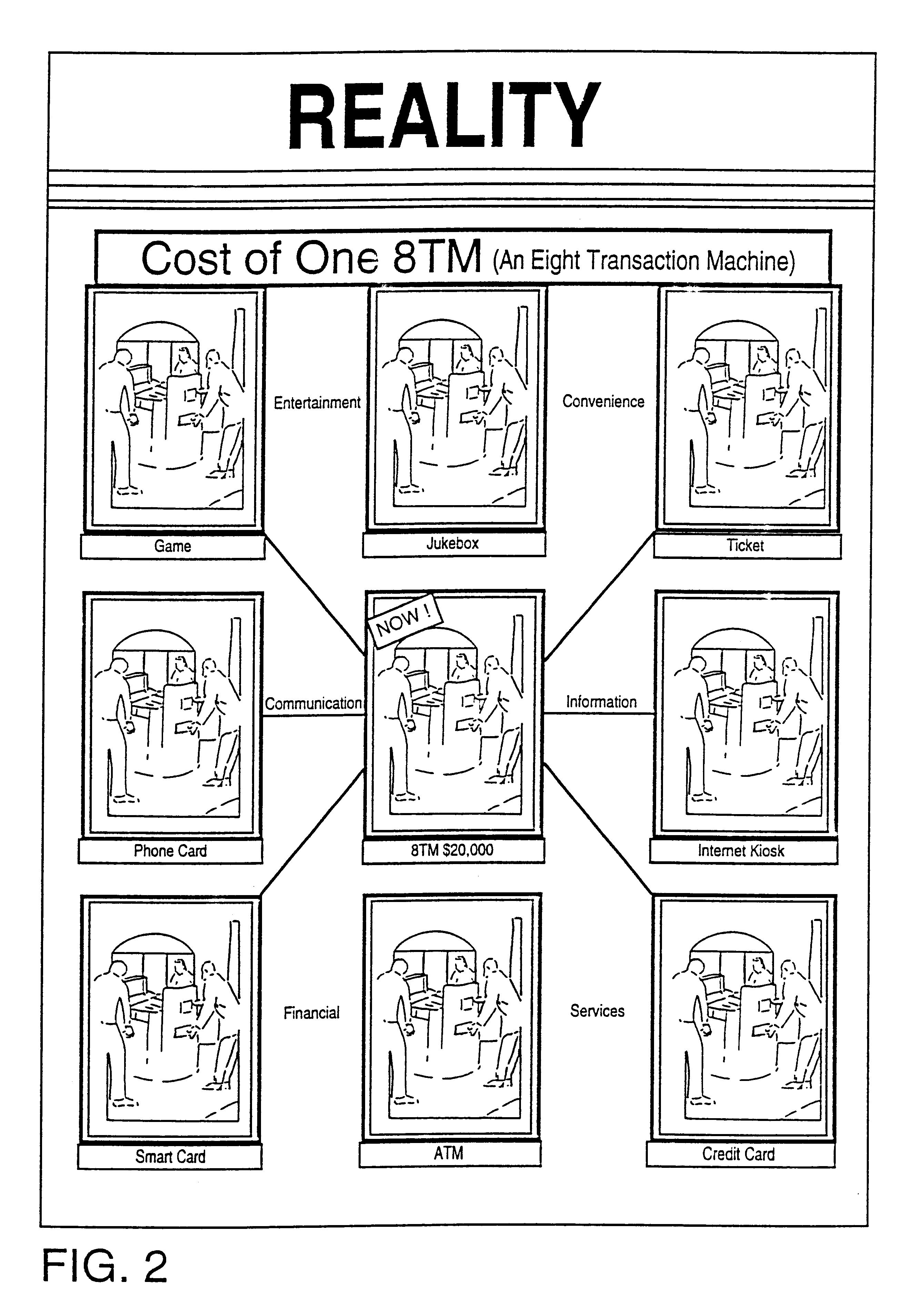

Automated banking machine system and method

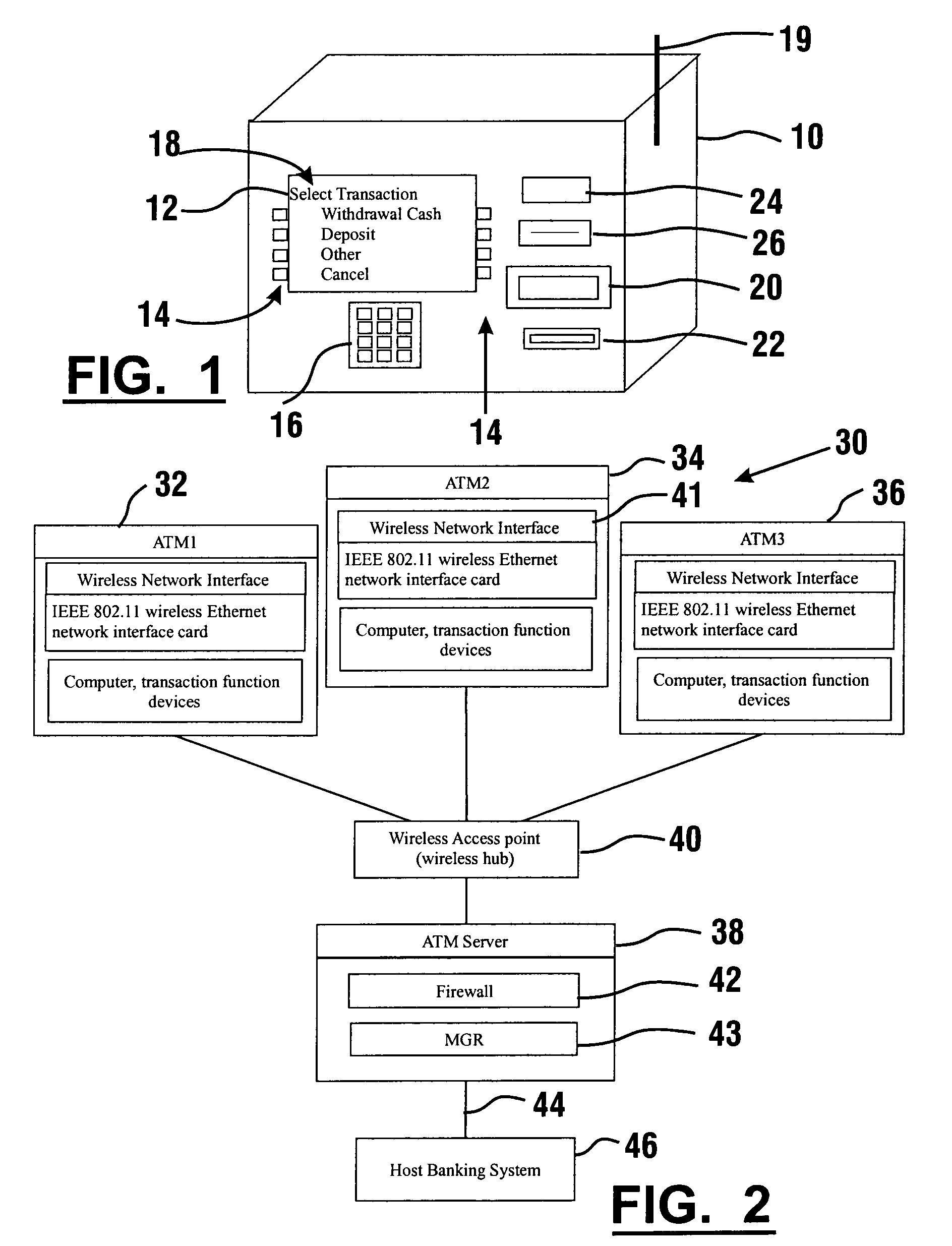

InactiveUS7025256B1Reduce interceptionComplete banking machinesFinanceWireless transmissionPrivate network

A wireless ATM system (30) comprises one or more wireless ATMs (32, 34, 36) that are operative to wirelessly communicate with a wireless ATM server (38). The wireless ATMs each include a wireless network interface (41). The wireless ATM server includes a corresponding wireless access point or wireless hub (40). Wireless transmission between the wireless ATMs and wireless ATM server is secured with a wireless encryption protocol. The wireless ATM server is operative to communicate with at least one host banking system (46) through at least one public or private network (44). The wireless ATM server is operative to route transaction and event messages between the host banking system and each of the wireless ATMs using a message gateway router (43). The wireless ATM server further includes a firewall (42).

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

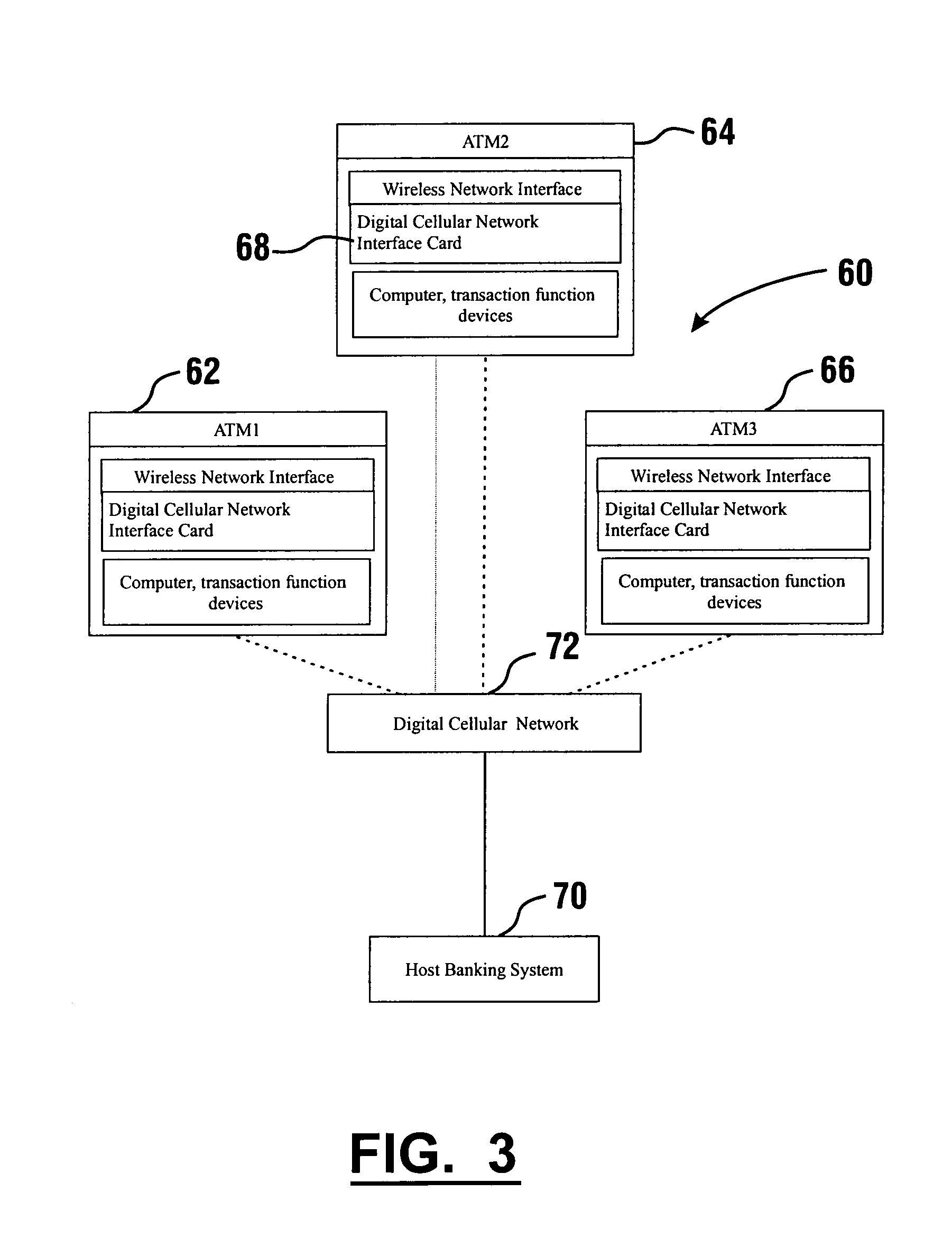

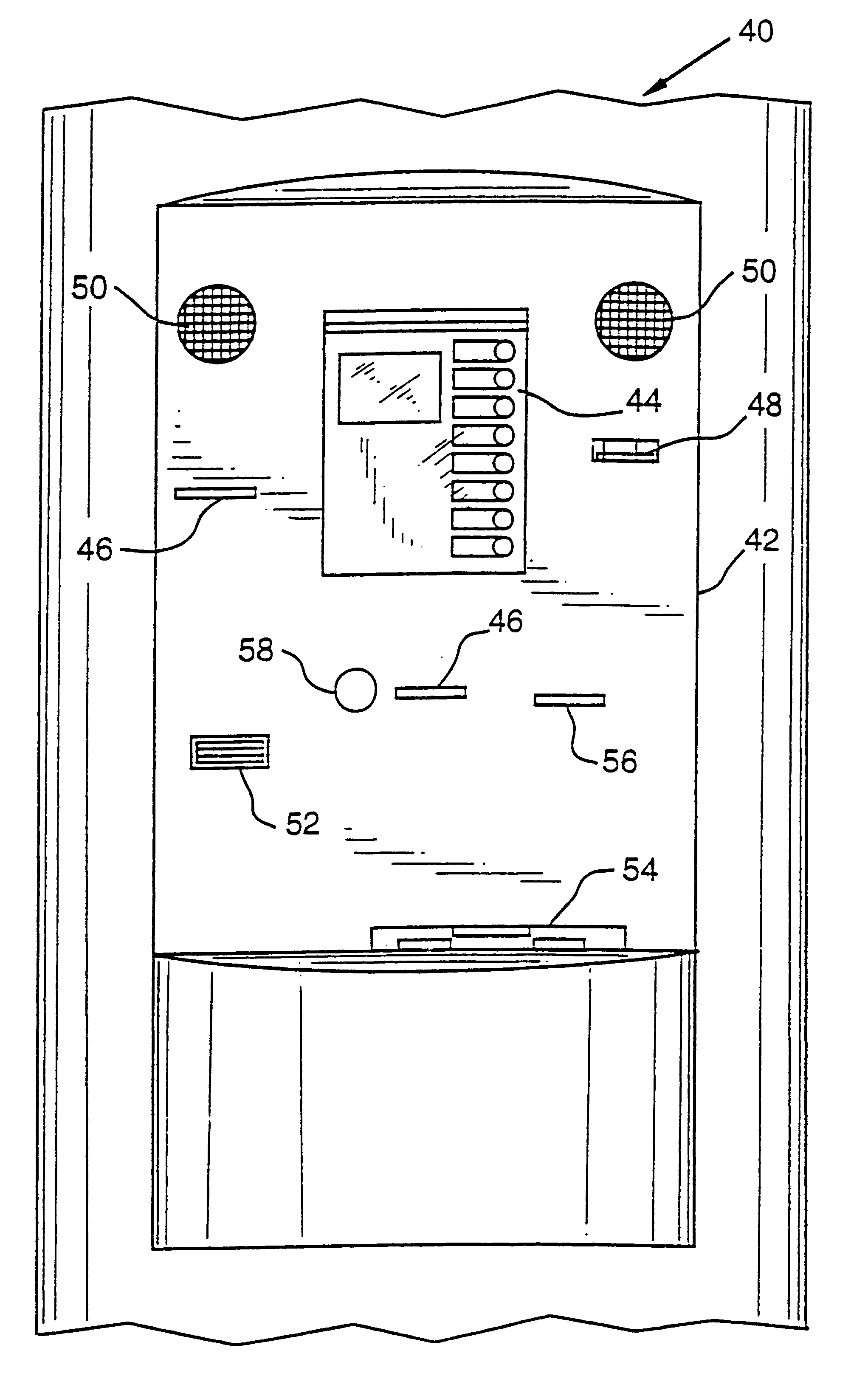

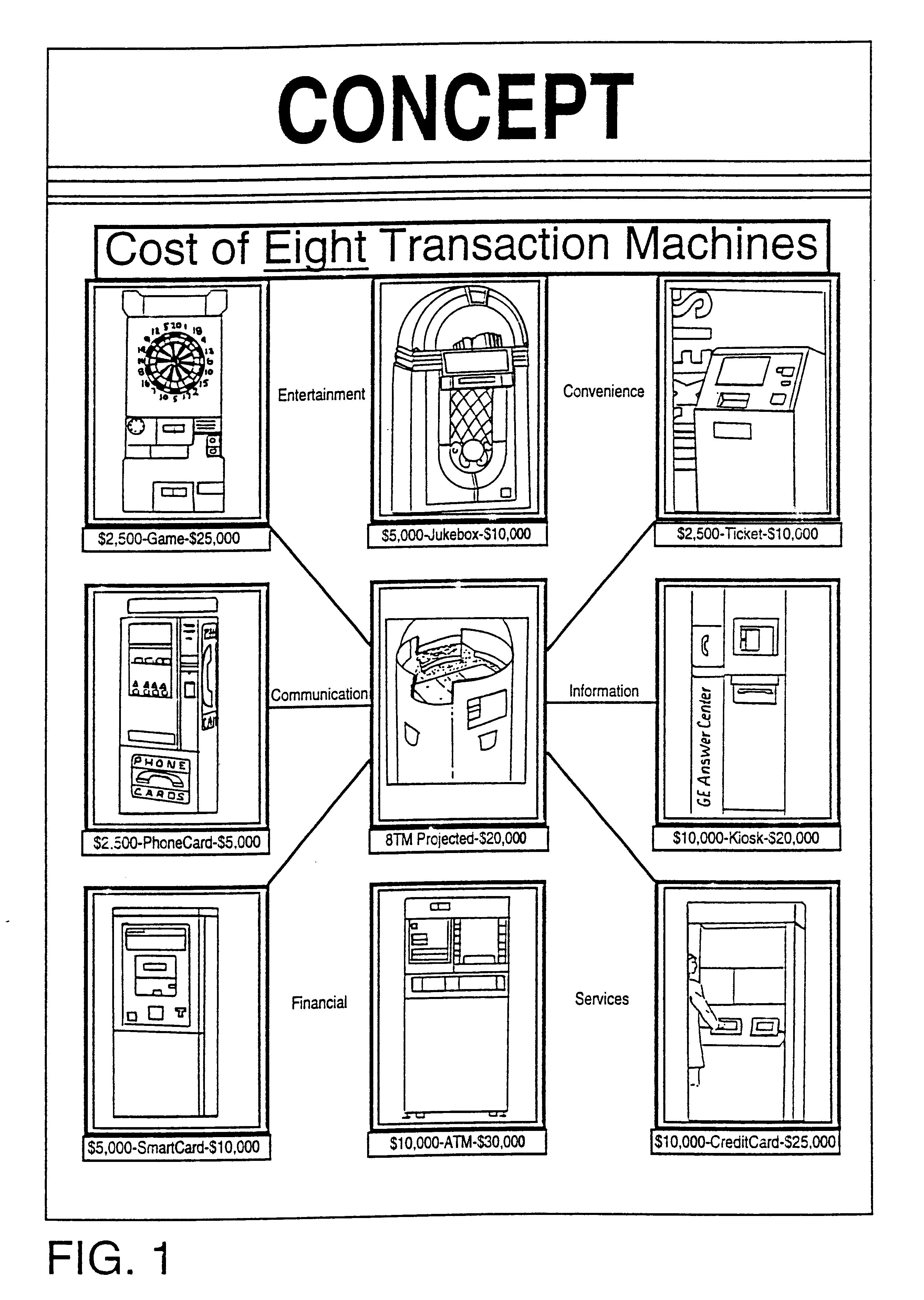

Automated transaction machine

An automated retail terminal in which a plurality of goods and / or services are provided in an integrated system (40). The integrated system (40) generally avoids duplicating hardware or functions in the course of delivering the goods or services offered, so for example in a combination ATM and Internet kiosk the same credit card or smart card reader (48) is used for both the ATM and the Internet kiosk functions, the same control screen (42, 44) activates the ATM functions and the Internet functions, and etc.

Owner:TRANSACTION HLDG L L C

Cash dispensing automated banking machine system and communication method

InactiveUS7606767B1Easy to operateMaintain securityFinancePayment architectureApplication serverMachining system

A method of operating an automated banking machine is provided. The method comprises sending a configuration XML message to an ATM from an application server, wherein the configuration XML data includes configuration data targeted to the ATM. The method also includes sending with the application server an application XML message to the ATM, wherein the application XML message includes application data. In addition, the method includes mapping the application data to at least one corresponding resource on the ATM responsive to the configuration data. In addition, the method includes performing a banking transaction using the at least one resource on the ATM responsive to the application XML message.

Owner:DIEBOLD NIXDORF

Financial transaction processing system and method

InactiveUS6302326B1Easy to develop and modifyEasy to changeComplete banking machinesHand manipulated computer devicesRelational databaseFinancial transaction

A financial transaction processing system (10) enables processing transactions from various types of card activated terminal devices (12) which communicate using a variety of electronic message formats. The transaction processing system includes among its software components message gateway routers (MGRs) (24, 164) which operate using information stored in the relational database to convert messages from a variety of external message formats used by the external devices and authorization systems, to a common internal message format used within the system. The system further uses database information to internally route messages to message processing programs (MPPs) (108, 138) which process messages and generate messages to the external devices and authorization systems. The MGR also converts the outgoing messages from the internal message format to the external message formats which can be interpreted by the external devices and systems to which the messages are directed.

Owner:DIEBOLD NIXDORF

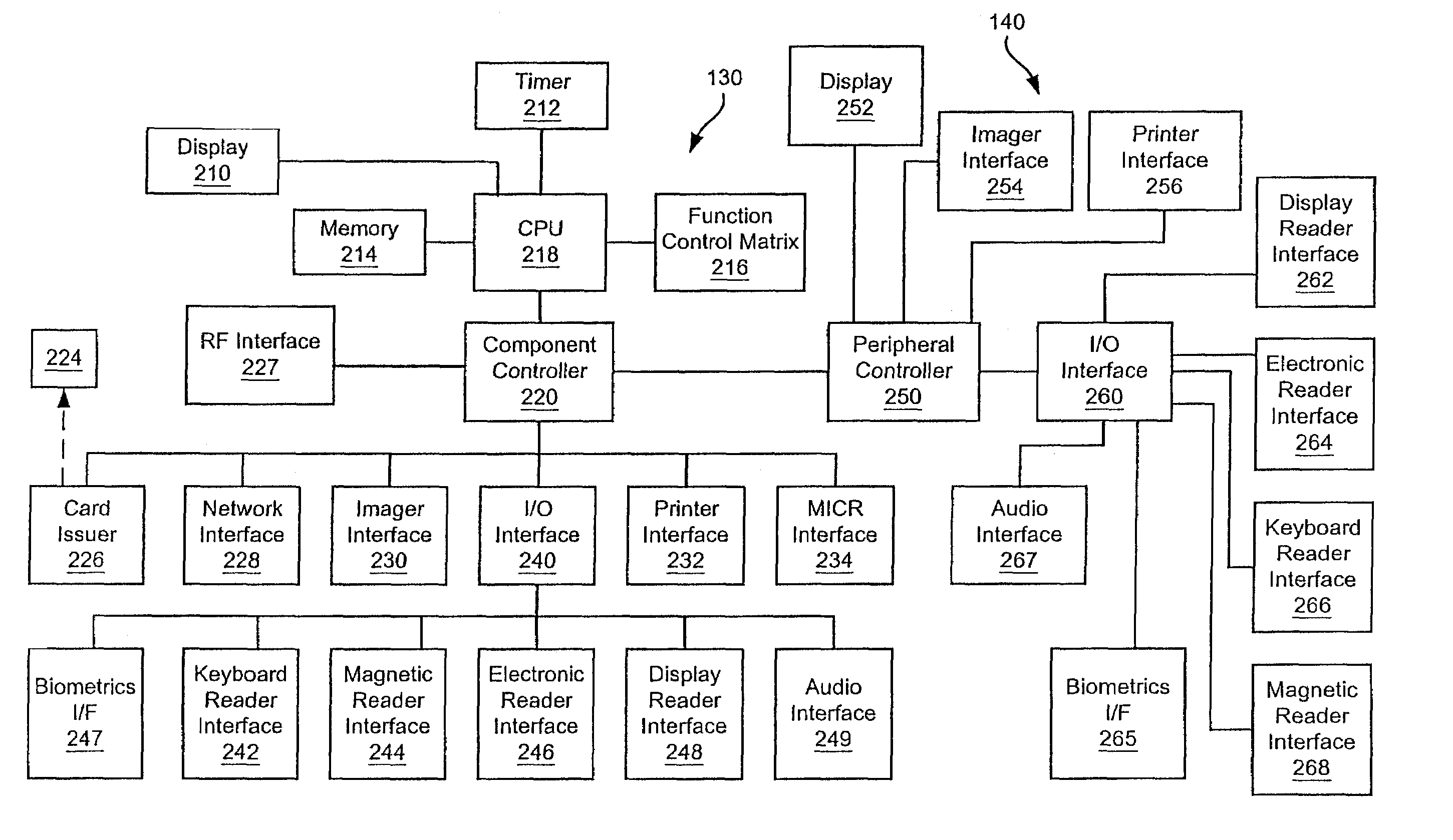

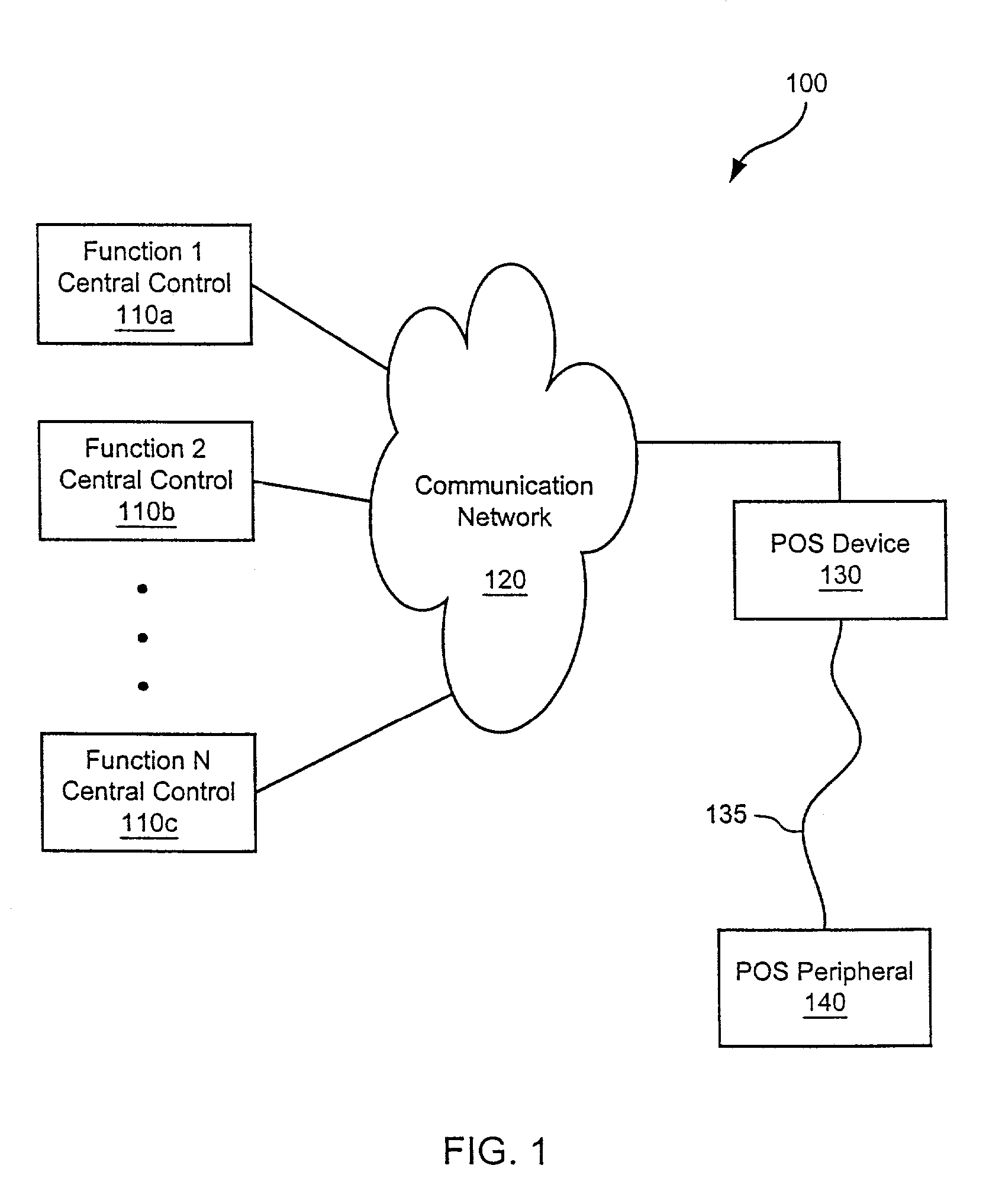

Systems and methods for configuring a point-of-sale system

Among other things, the present invention provides a variety of systems and methods for configuring and / or providing a configurable point-of-sale system. Various methods of the present invention include providing a point-of-sale device and coupling it to a communication network. One or more transaction systems are accessible to the point-of-sale device via the transaction network, instructions are loaded to the memory of the point-of-sale device allowing it to access the transaction system. Various systems include a plurality of point-of-sale devices communicably coupled to various transaction systems via a communication network. The point-of-sale devices can be configurable to access one or more of the various transaction systems.

Owner:THE WESTERN UNION CO +1

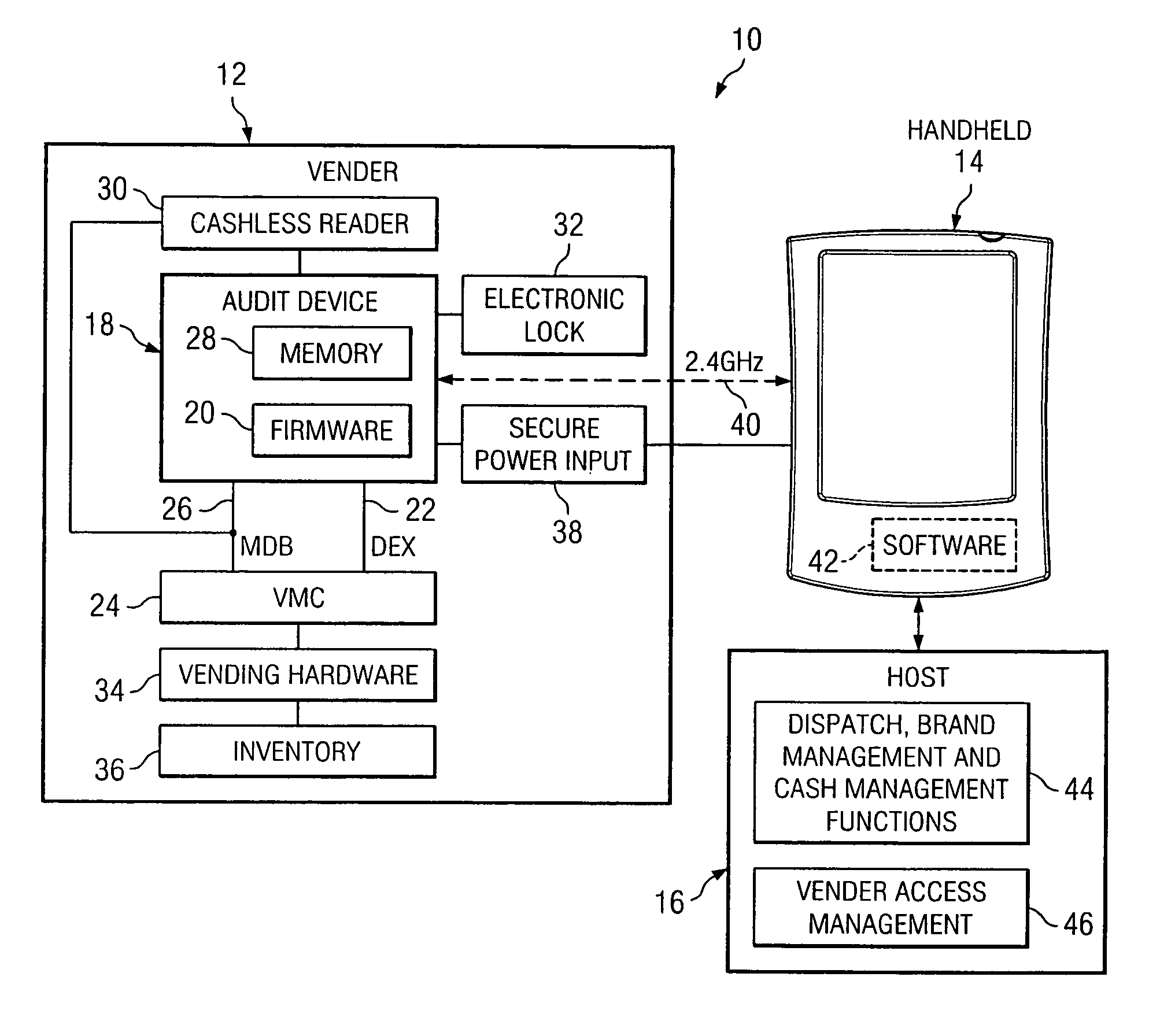

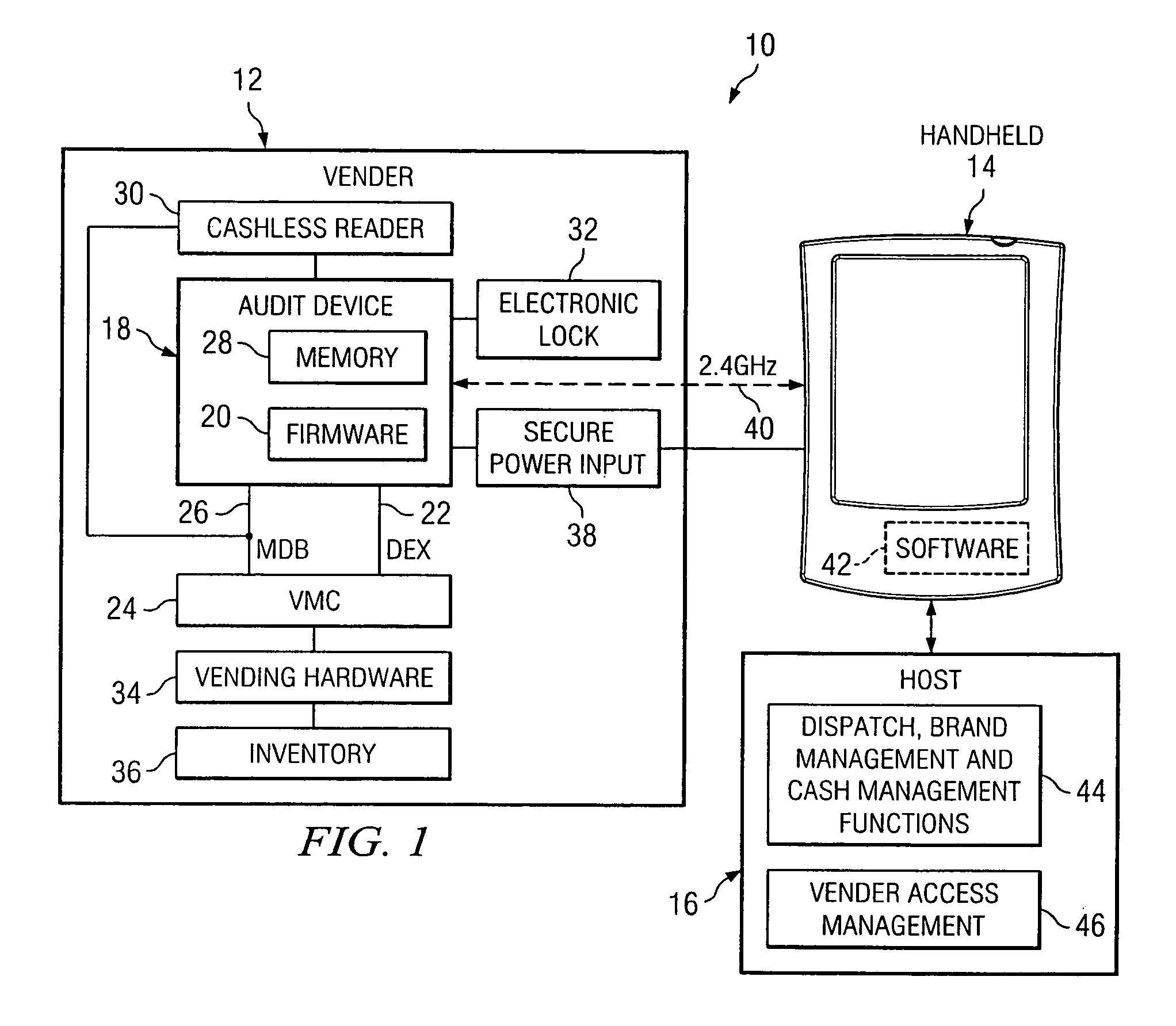

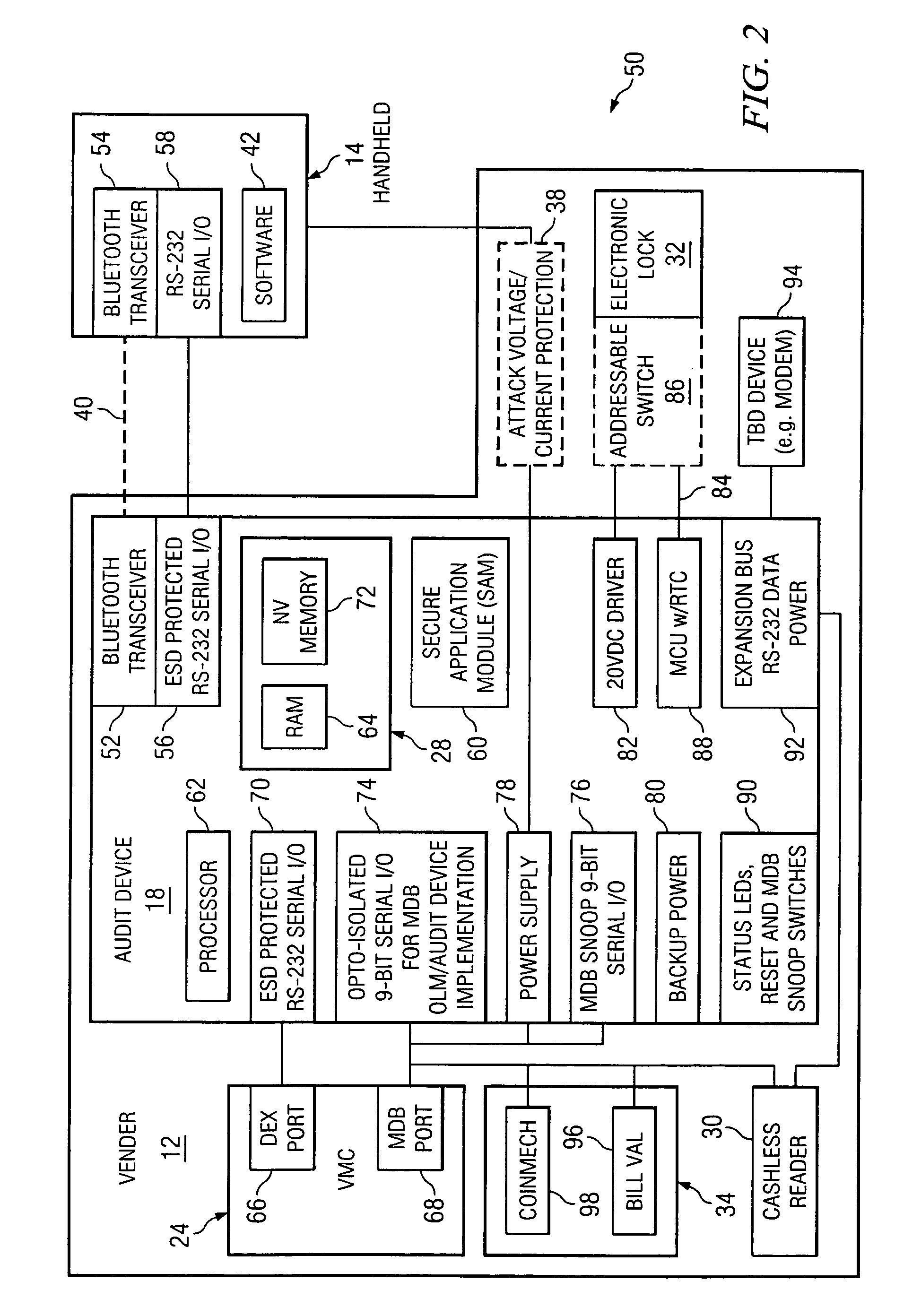

System, method and apparatus for vending machine wireless audit and cashless transaction transport

InactiveUS7167892B2Avoid communicationControlling coin-freed apparatusCoin-freed apparatus detailsTimestampTransaction data

The present invention provides a system, method and apparatus for collecting, storing and communicating vending machine transaction data. The system preferably includes an embedded data collection and storage device that, when placed inside a vending machine, will collect both DEX and MDB data using a combination of ad-hoc scheduling and trigger-based events. In addition, the embedded data collection and storage device may collect transaction data concerning handheld transactions as well as vending machine error transactions, including timestamps. Functionality operable to permit handheld computer communication with the vending machine, as well as at least a cashless media transaction device may also be included. Data transferred to the handheld computer may be subsequently communicated to one or more host applications or credit agencies.

Owner:CRANE MERCHANDISING SYSTEMS

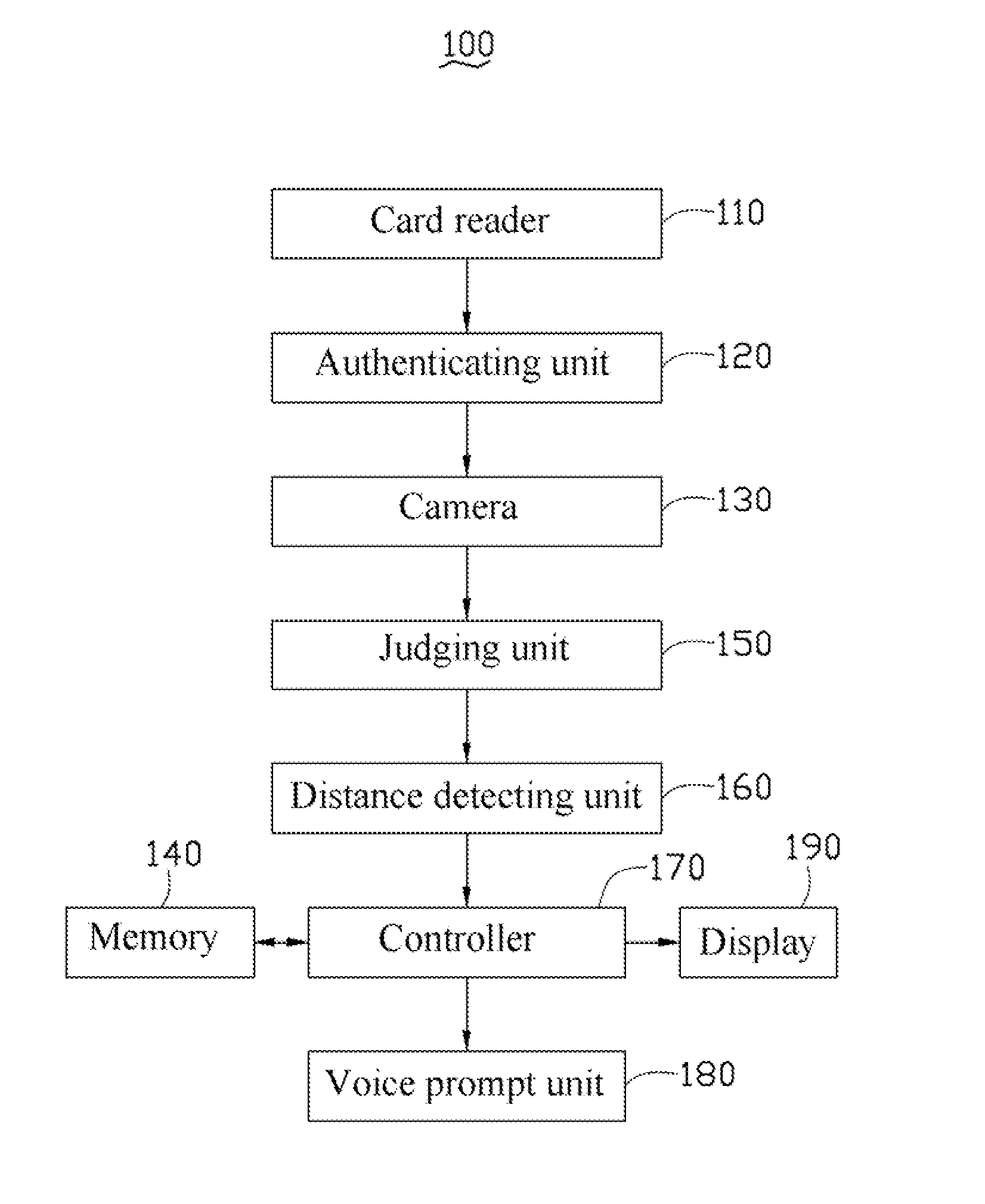

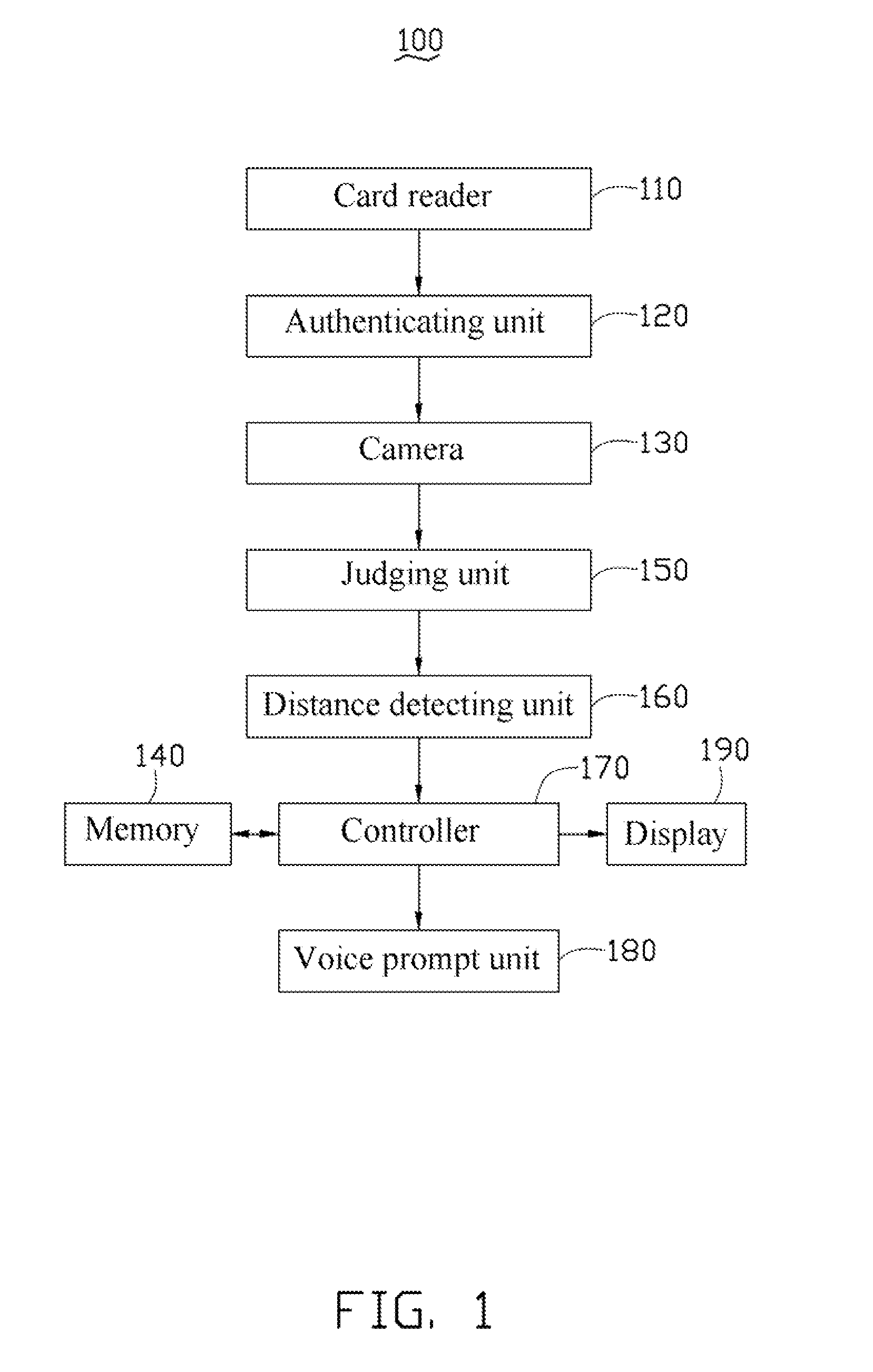

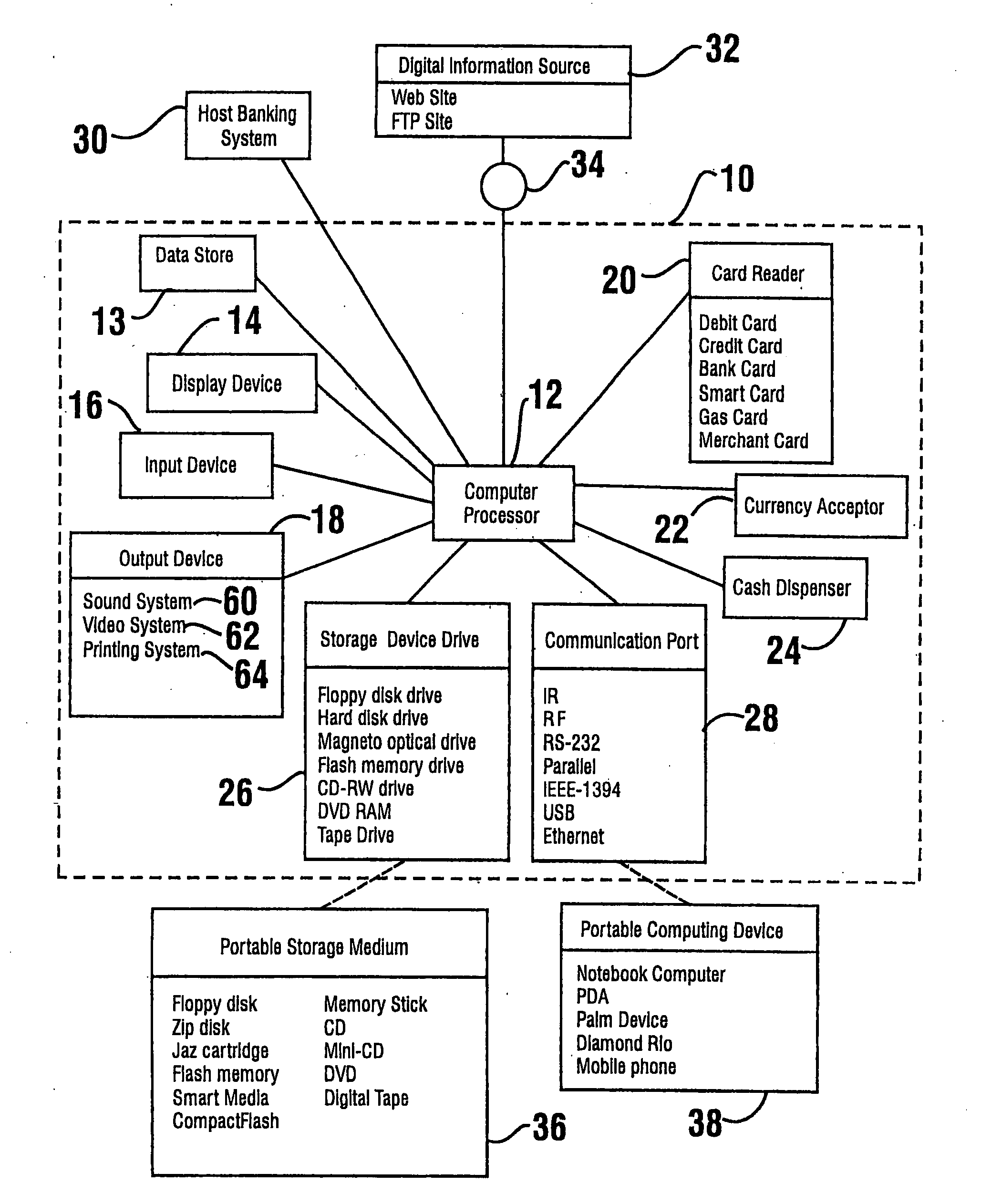

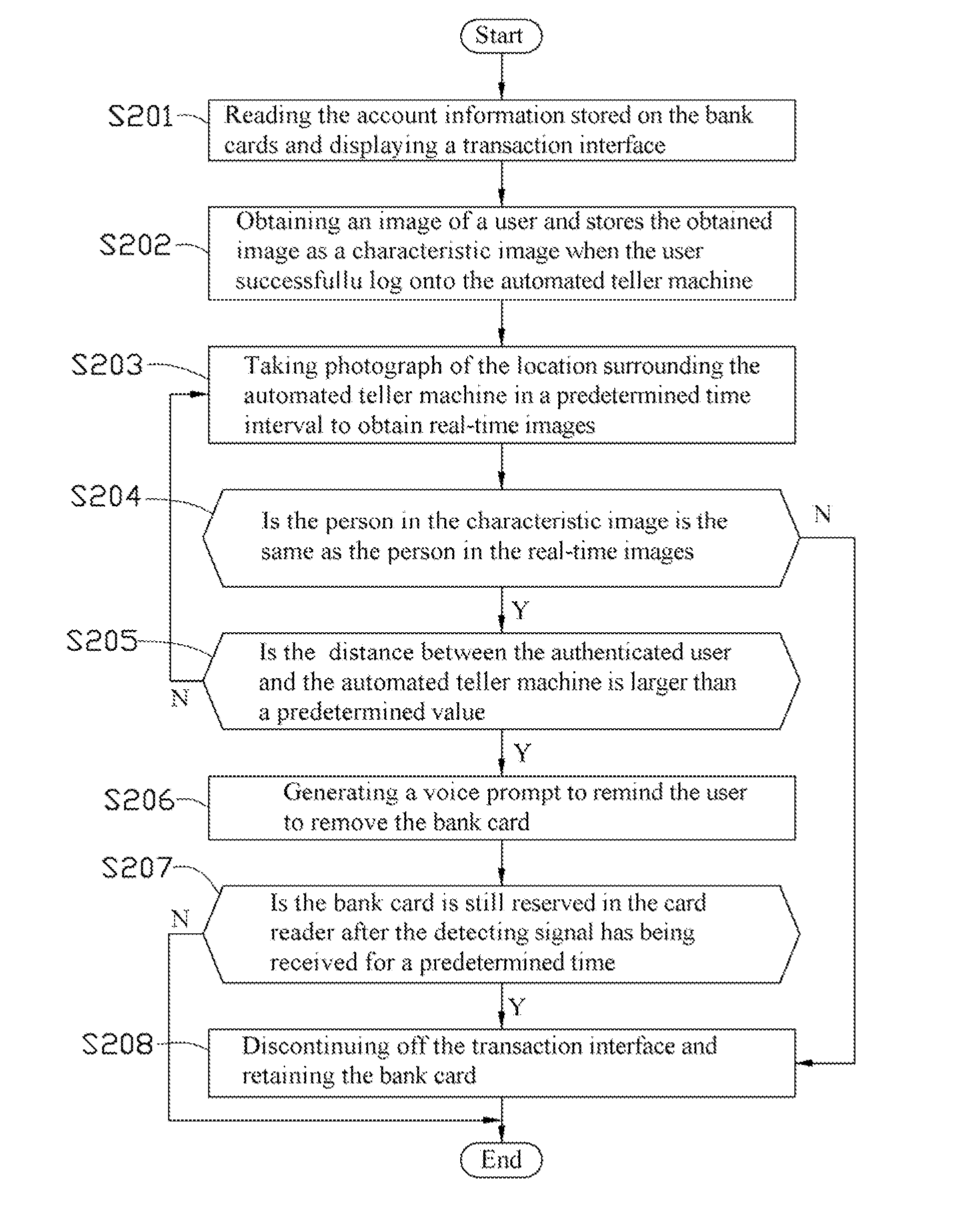

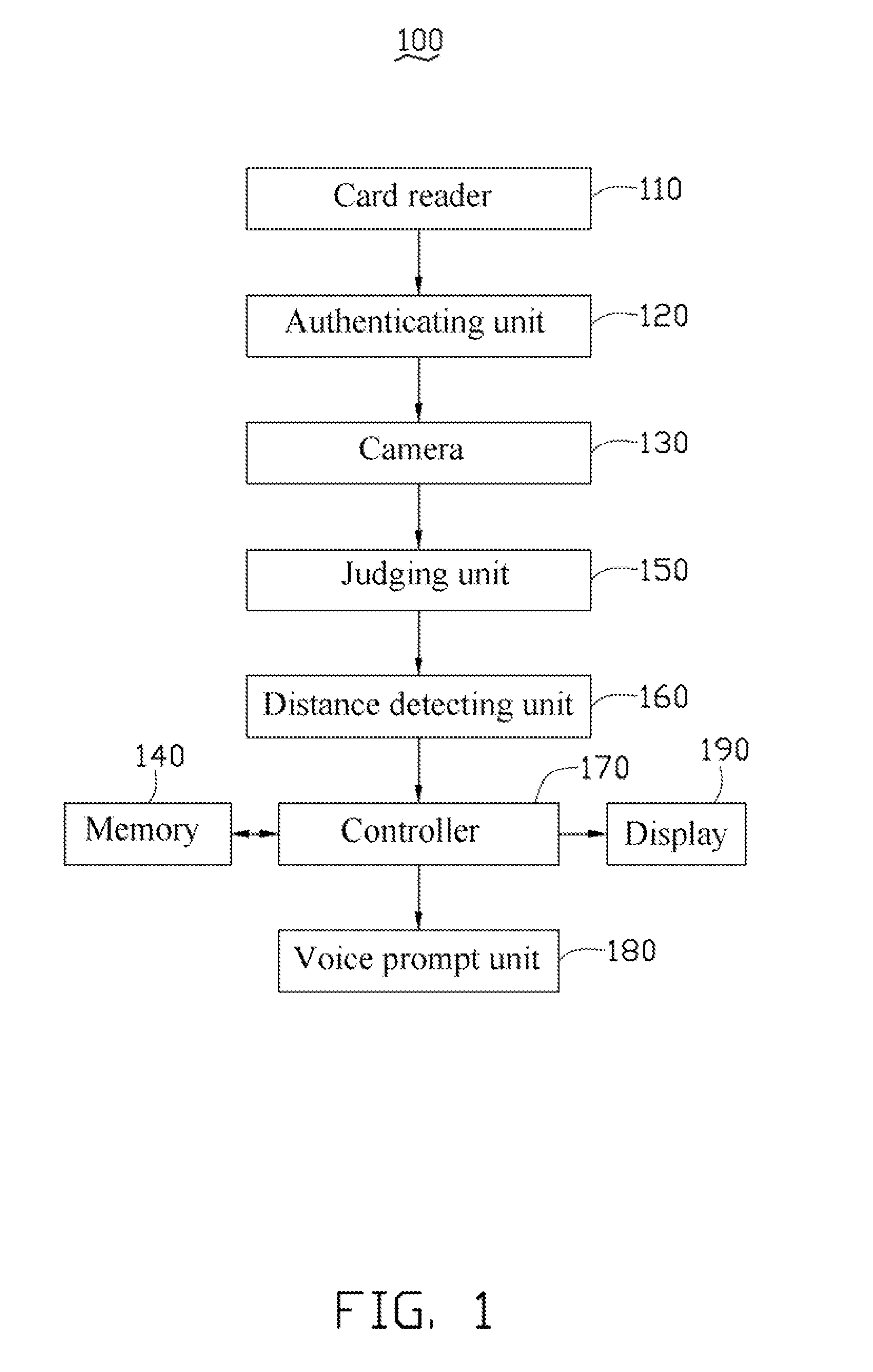

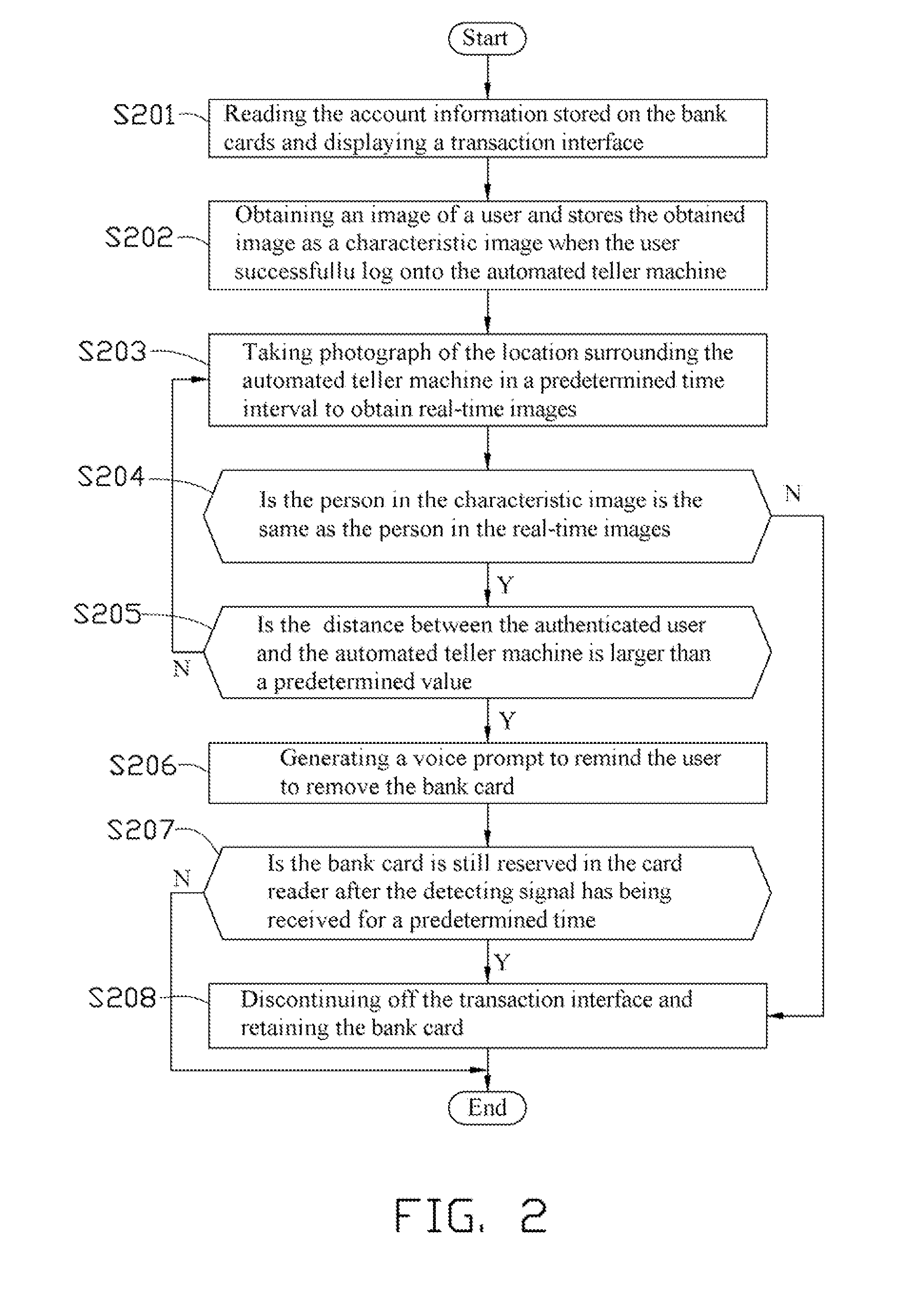

Automated teller machine and voice prompt method thereof

A voice prompt method includes obtaining an image of a user and storing the obtained image as a characteristic image when users successfully log onto an automated teller machine; taking photographs of the location surrounding the automated teller machine at predetermined time intervals to obtain real-time images; judging whether the person of the characteristic image is the same as the person in the real-time image; detecting whether the distance between the user and the automated teller machine is larger than a predetermined value if the person in the two images is judged to be the same; and generating a voice prompt to remind the user not to forget to remove his / her bank card if the distance between the user and the automated teller machine becomes larger than a predetermined value. An automated teller machine is also provided.

Owner:FU TAI HUA IND SHENZHEN +1

Automated banking machine system and method

A card actuated automated banking machine (152, 198, 200) includes a plurality of transaction function devices. The transaction function devices include a card reader (170), a printer (174), a bill dispenser (176), a coin dispenser (178), a display (182), a check imaging device (186) and at least one processor (190). The automated banking machine is operative responsive to receiving a check and certification data to dispense cash in exchange for the check. The person presenting the check need not provide user identifying inputs through input devices in order to receive cash for the check. A check recipient prior to presenting the check for payment is also enabled to verify that the check will be paid through communication with at least one computer (204) through at least one consumer interface device (208).

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

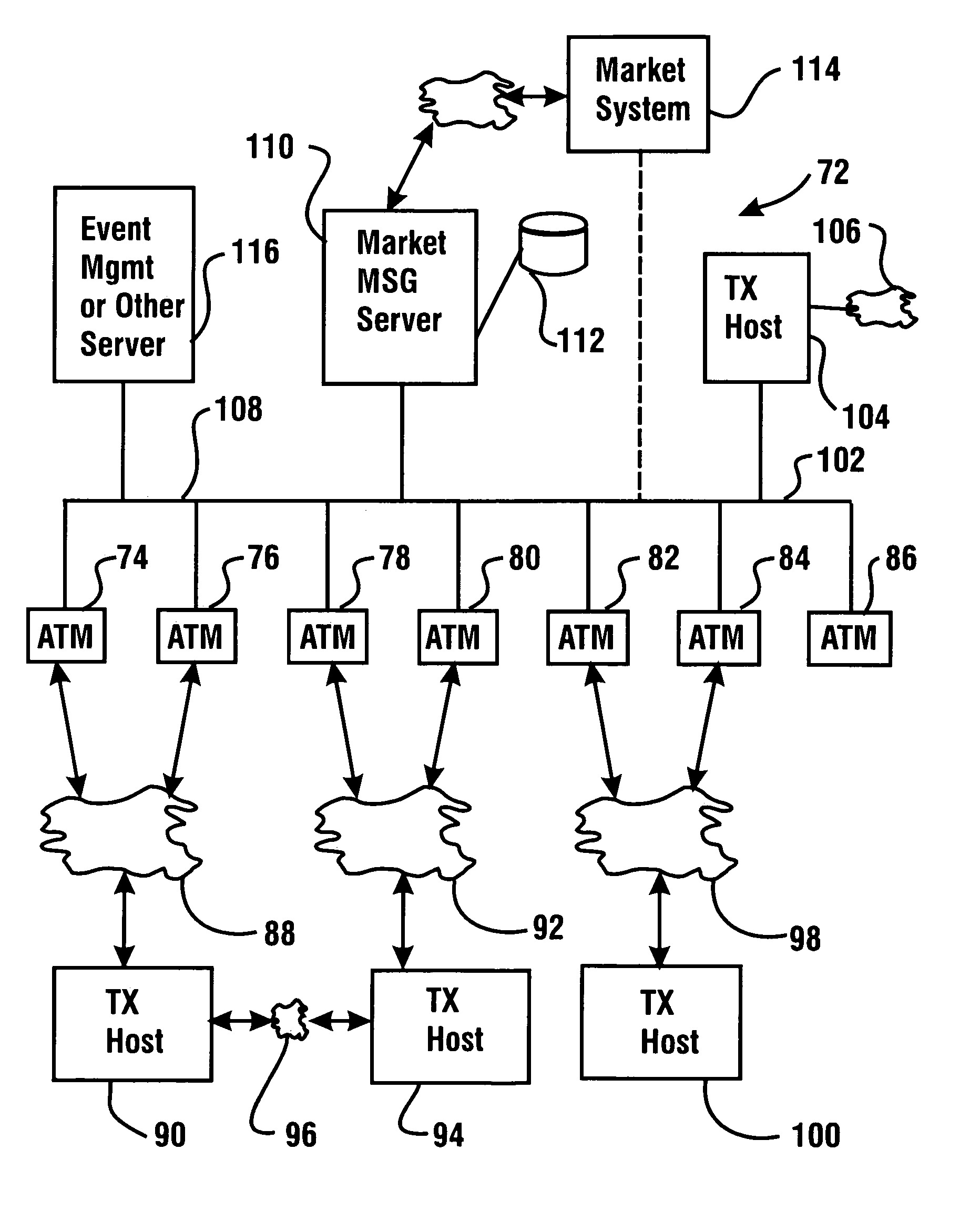

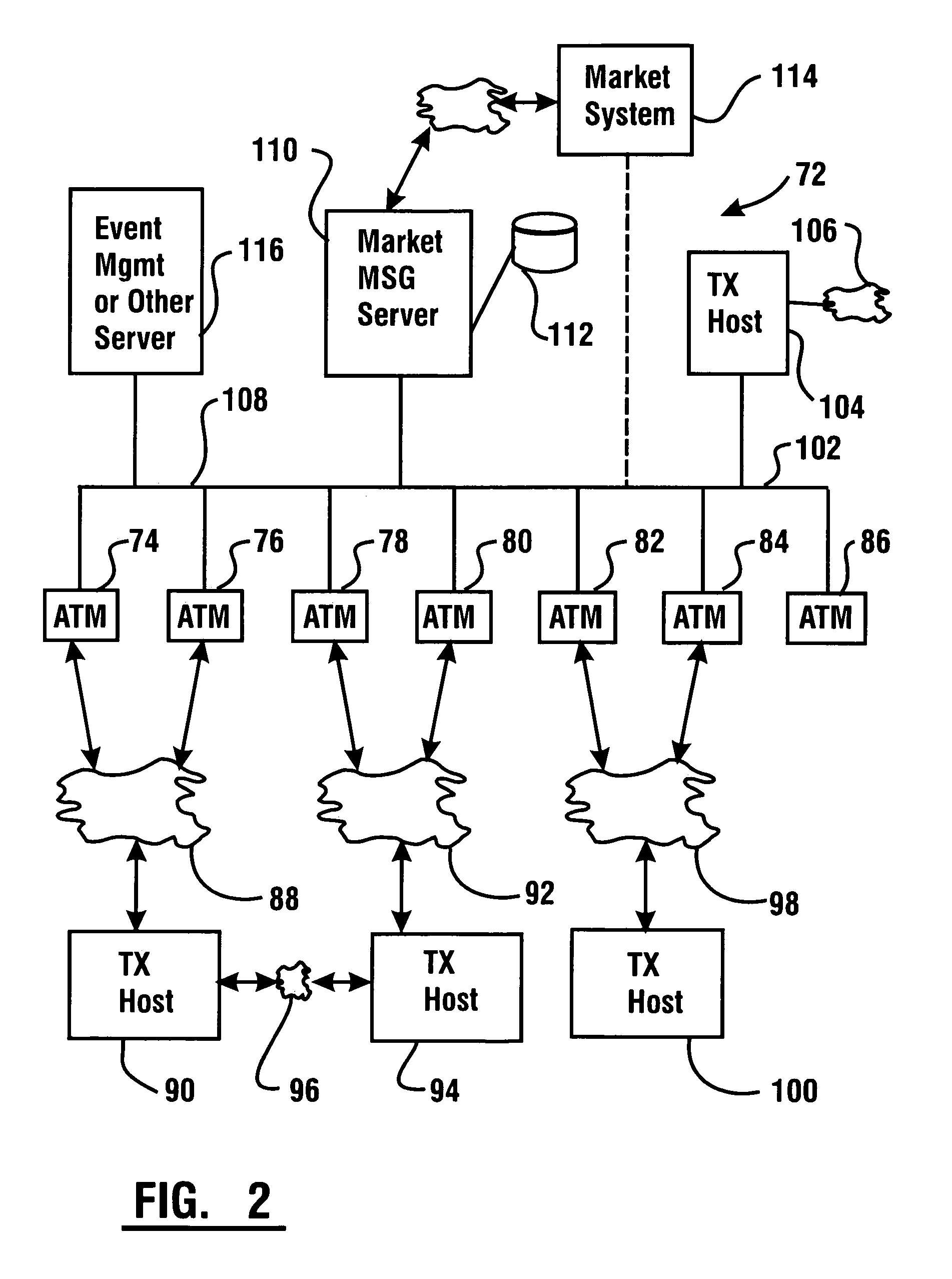

ATM customer marketing system

InactiveUS7039600B1Improve efficiencyComplete banking machinesDiscounts/incentivesFinancial transactionDatabase

A marketing system includes a plurality of automated transaction machines (74, 76, 78, 80, 82, 84, 86). The automated transaction machines operate to carry out financial transactions with associated host computers (90, 94, 100, 104). Marketing presentations are stored on and output from the transaction machines responsive to messages exchanged with a market message server (110) which is connected to the automated transaction machines through a network (108). The connection to the automated transaction machines which provides delivery of the market presentation materials and which causes the output of presentations, is generally independent of the messages associated with authorizing financial transactions. Some described embodiments of the invention enable presenting marketing campaigns to users of the transaction machines. The marketing campaigns may include sequences of presentations that are output on a targeted basis to particular users.

Owner:DIEBOLD NIXDORF

Automated teller machine and voice prompt method thereof

Owner:FU TAI HUA IND SHENZHEN +1

Method and system of detecting cash deposits and attributing value

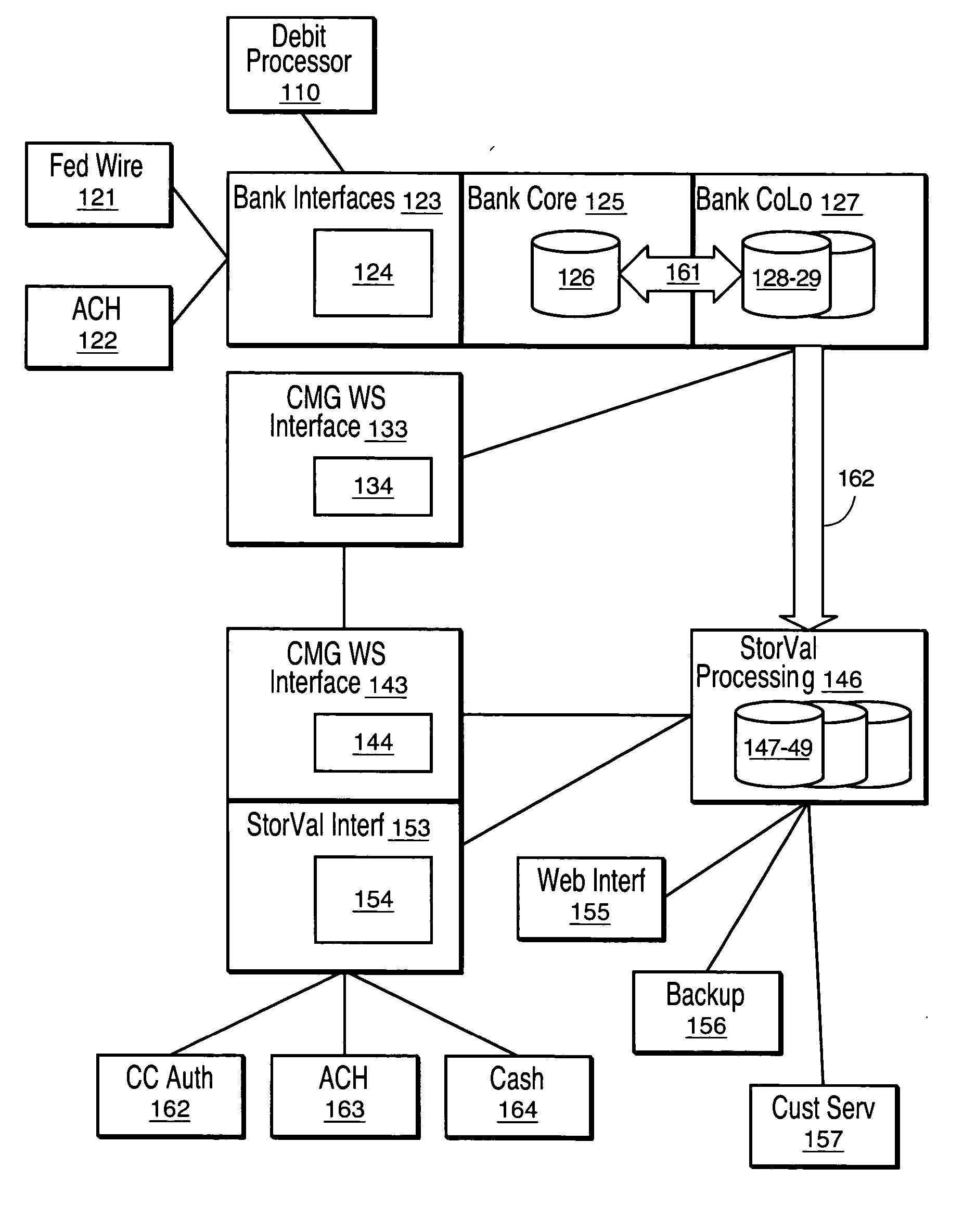

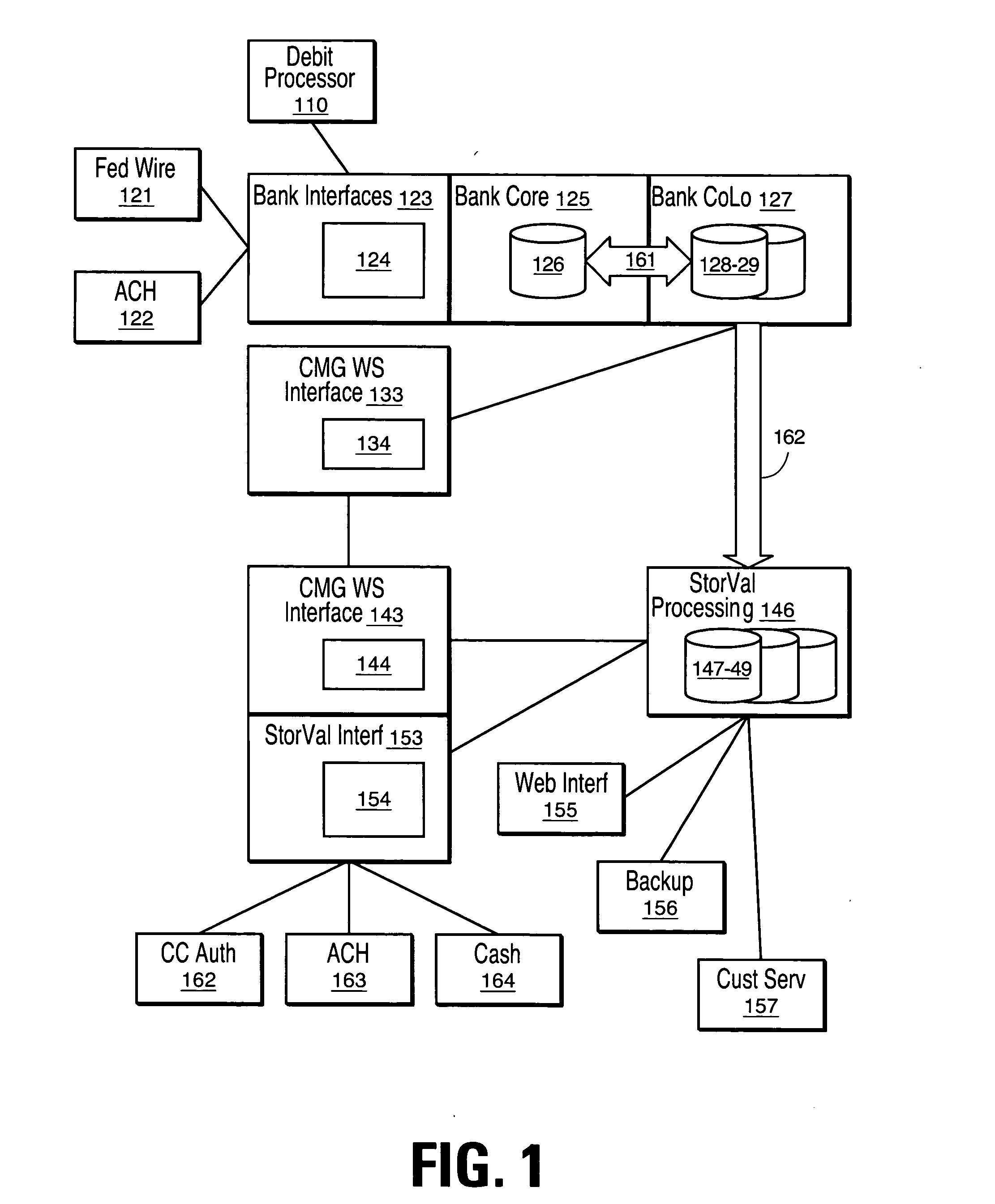

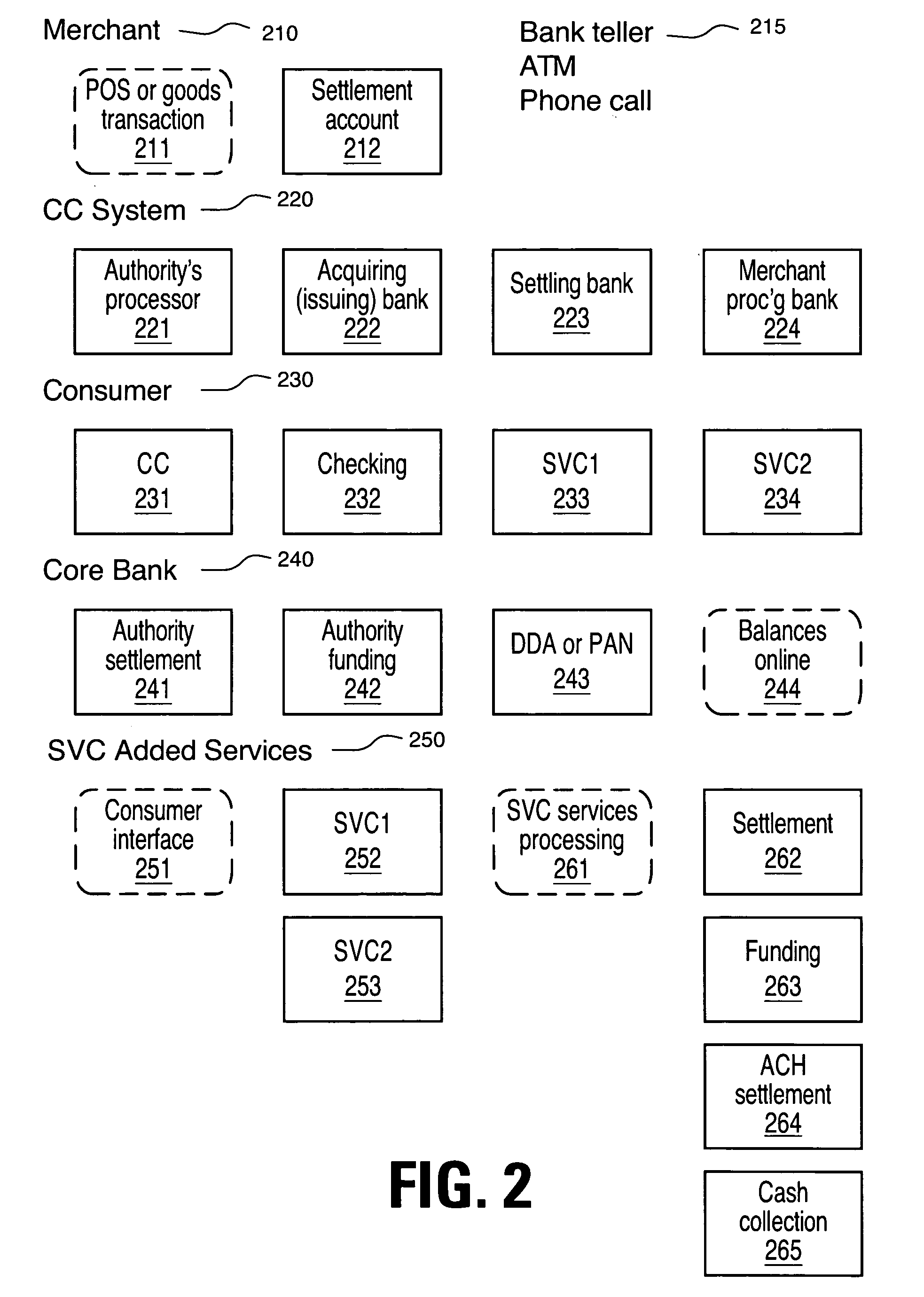

InactiveUS20060213980A1Improved bank processing systemPrevent fraudComplete banking machinesFinanceOperating systemStored-value card

The present invention relates to stored value cards and improved bank processing systems. In particular, it relates to systems and methods that load value into demand deposit and plastic account number accounts corresponding to the stored value card and make funds available without delay, even for the unbanked. It also relates to methods for avoiding fraud.

Owner:BLUKO INFORMATION GROUP

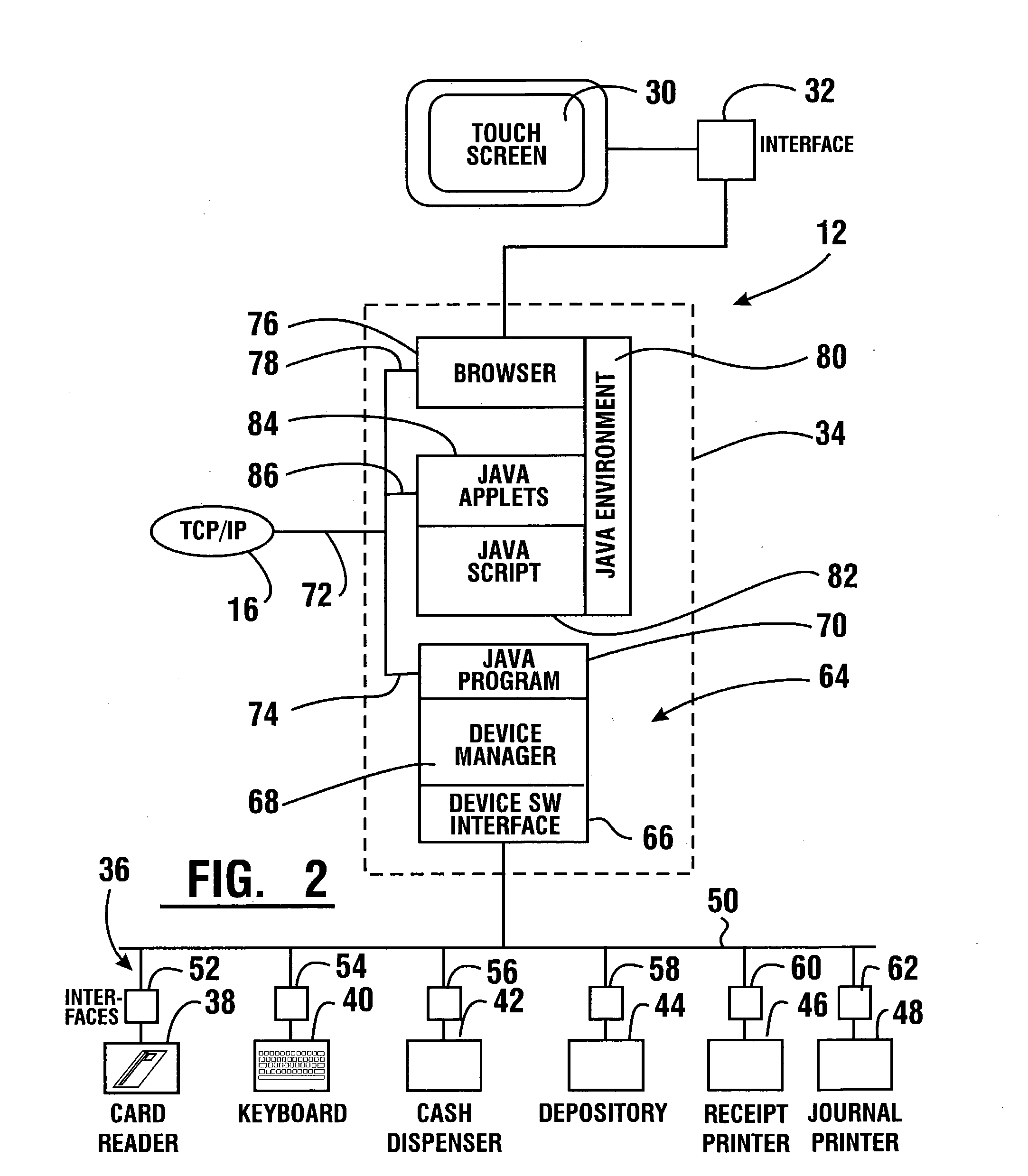

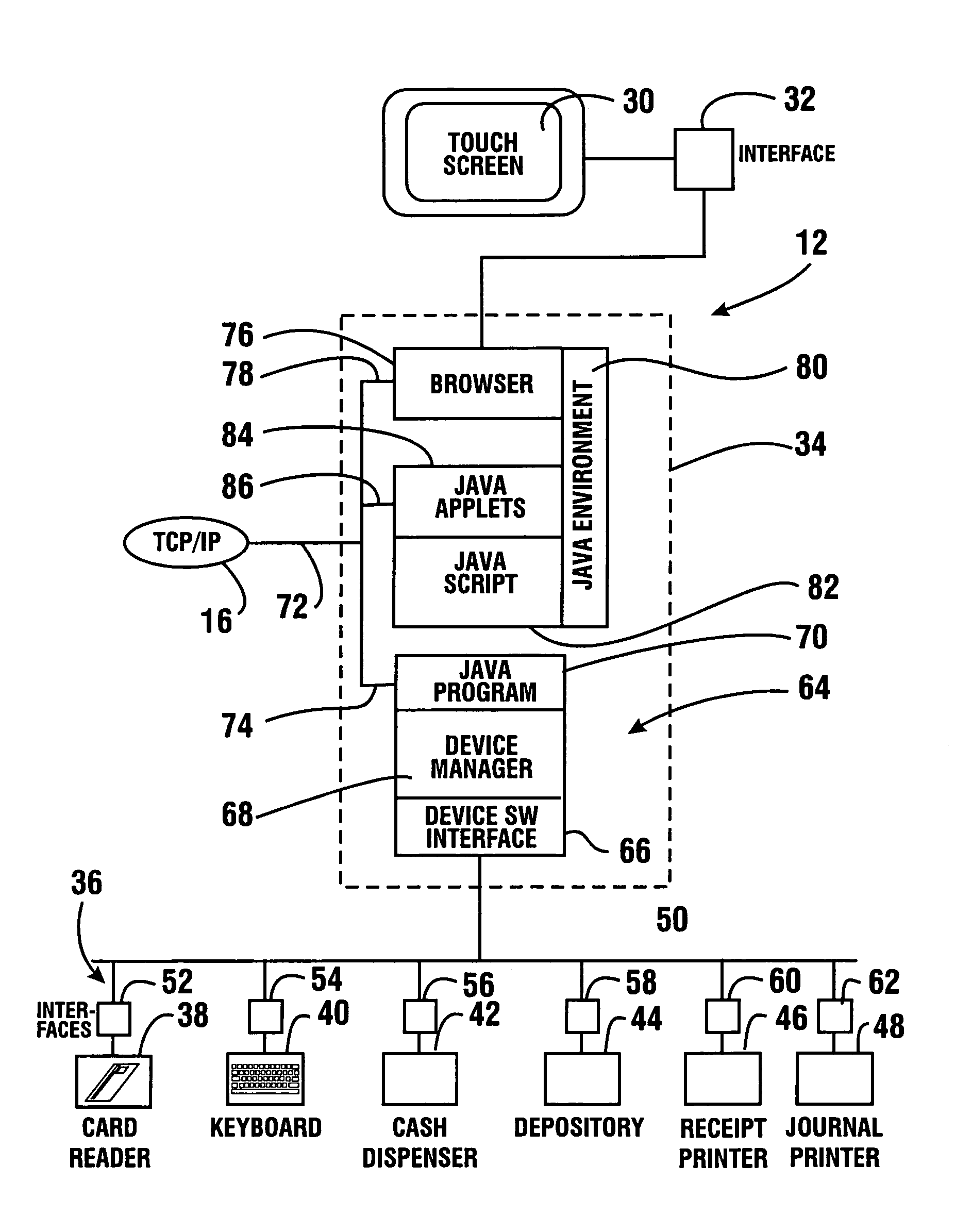

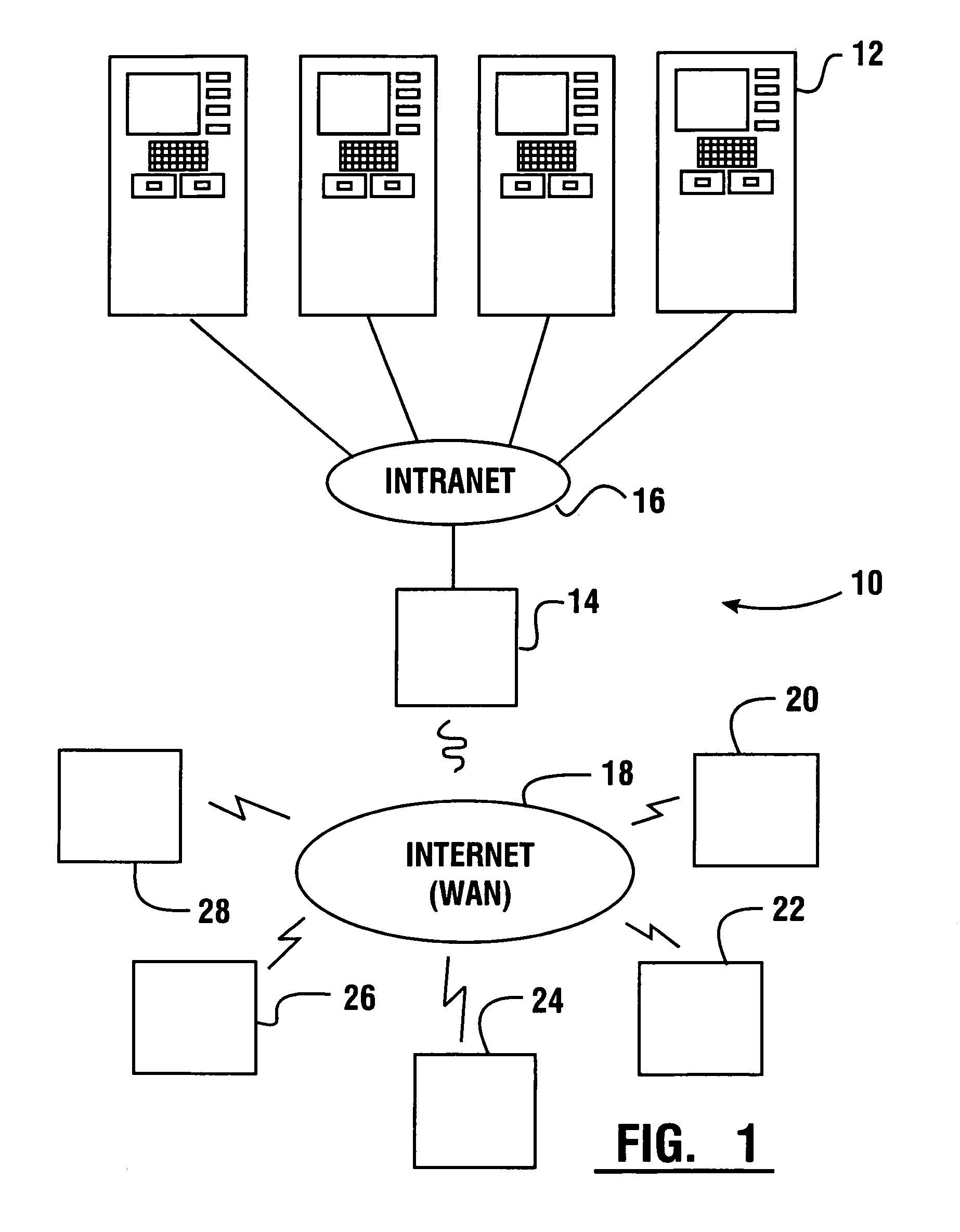

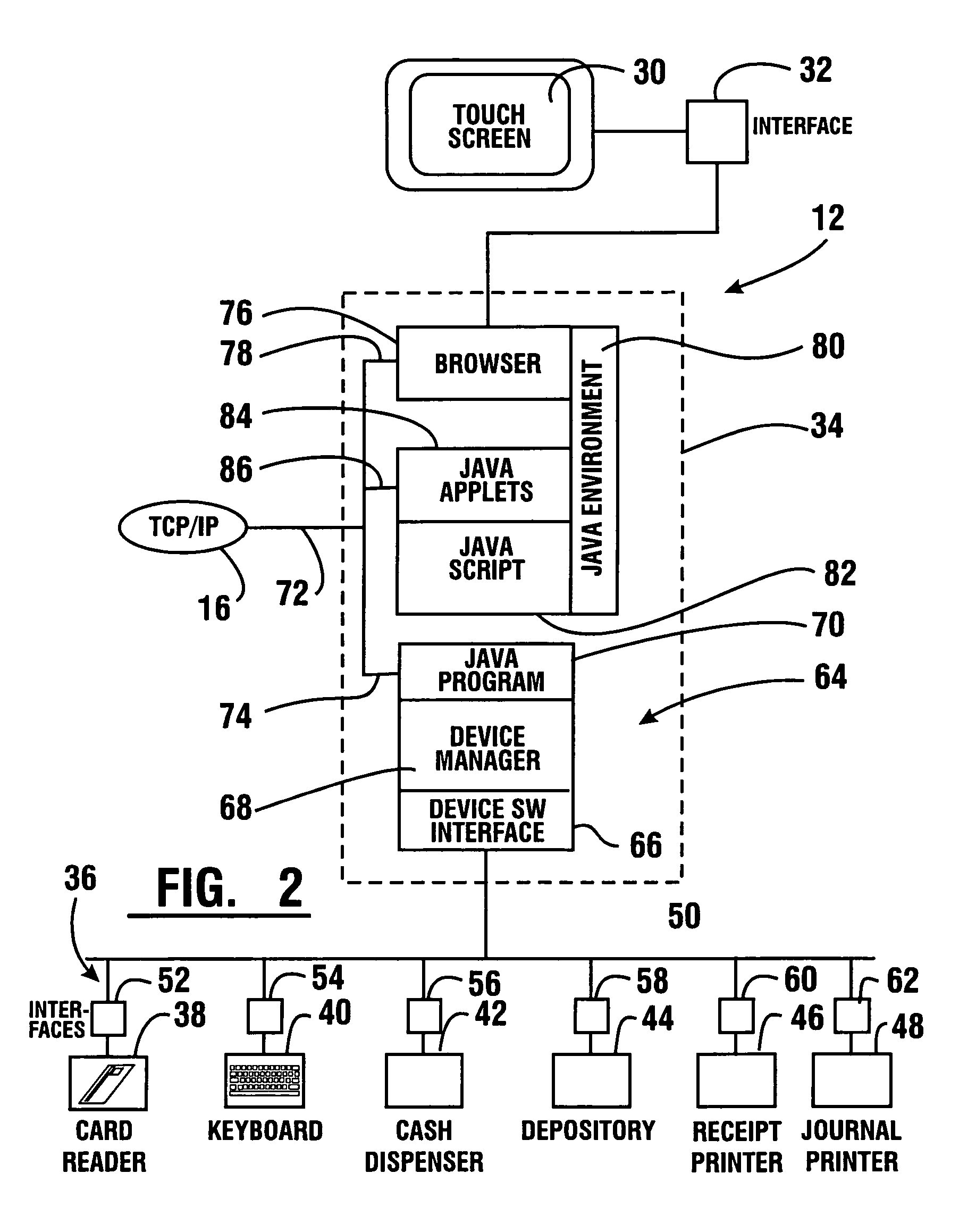

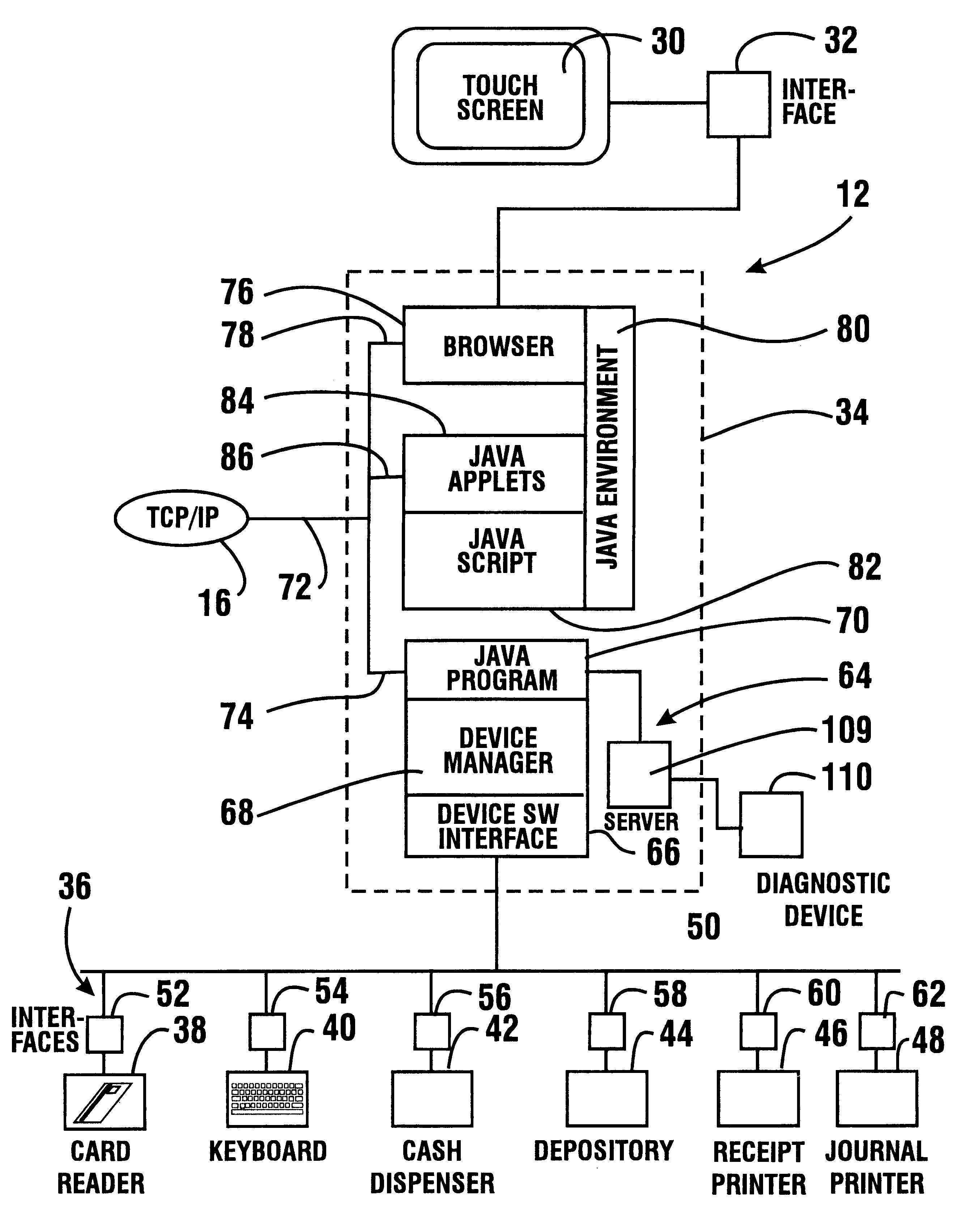

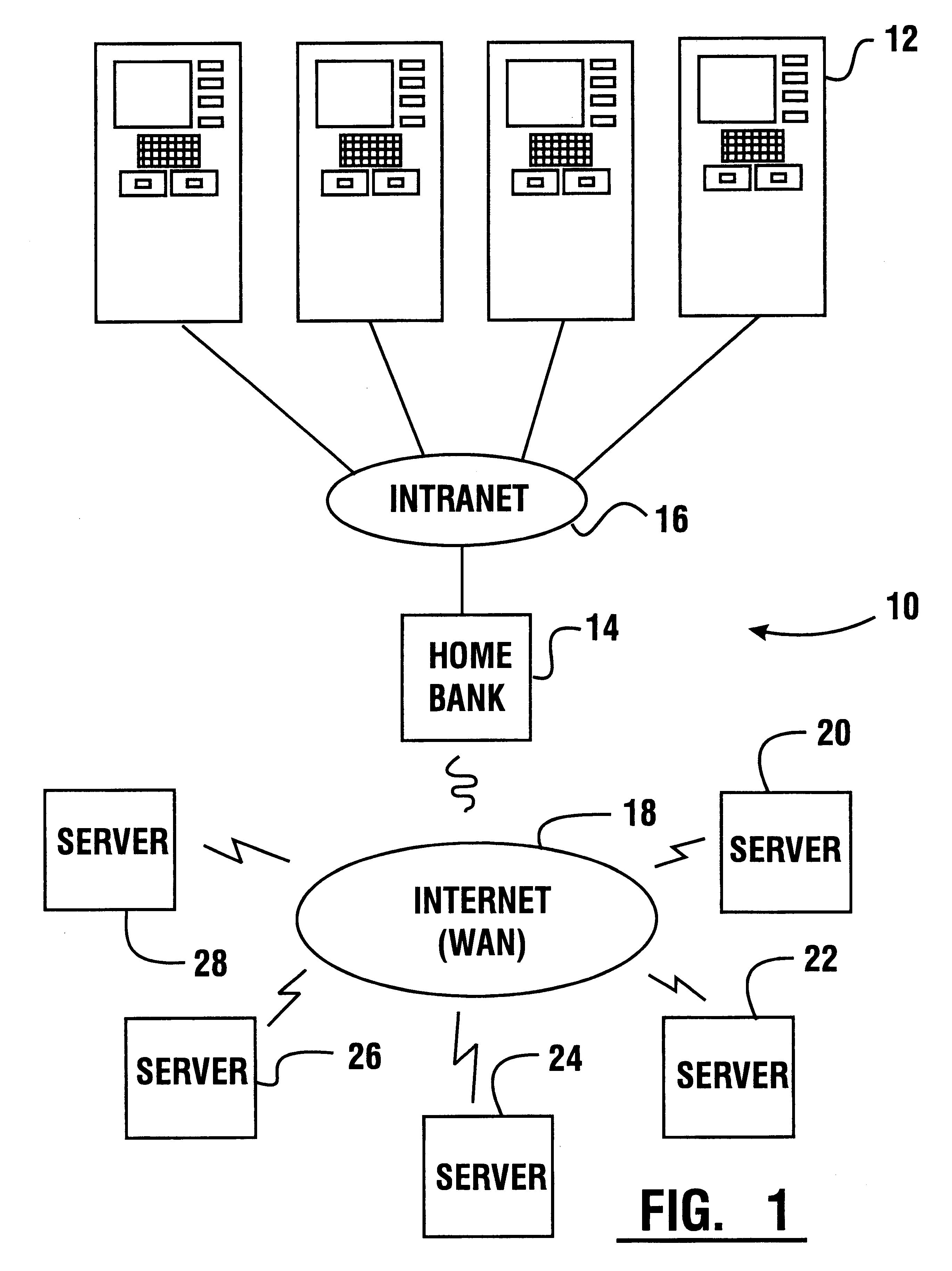

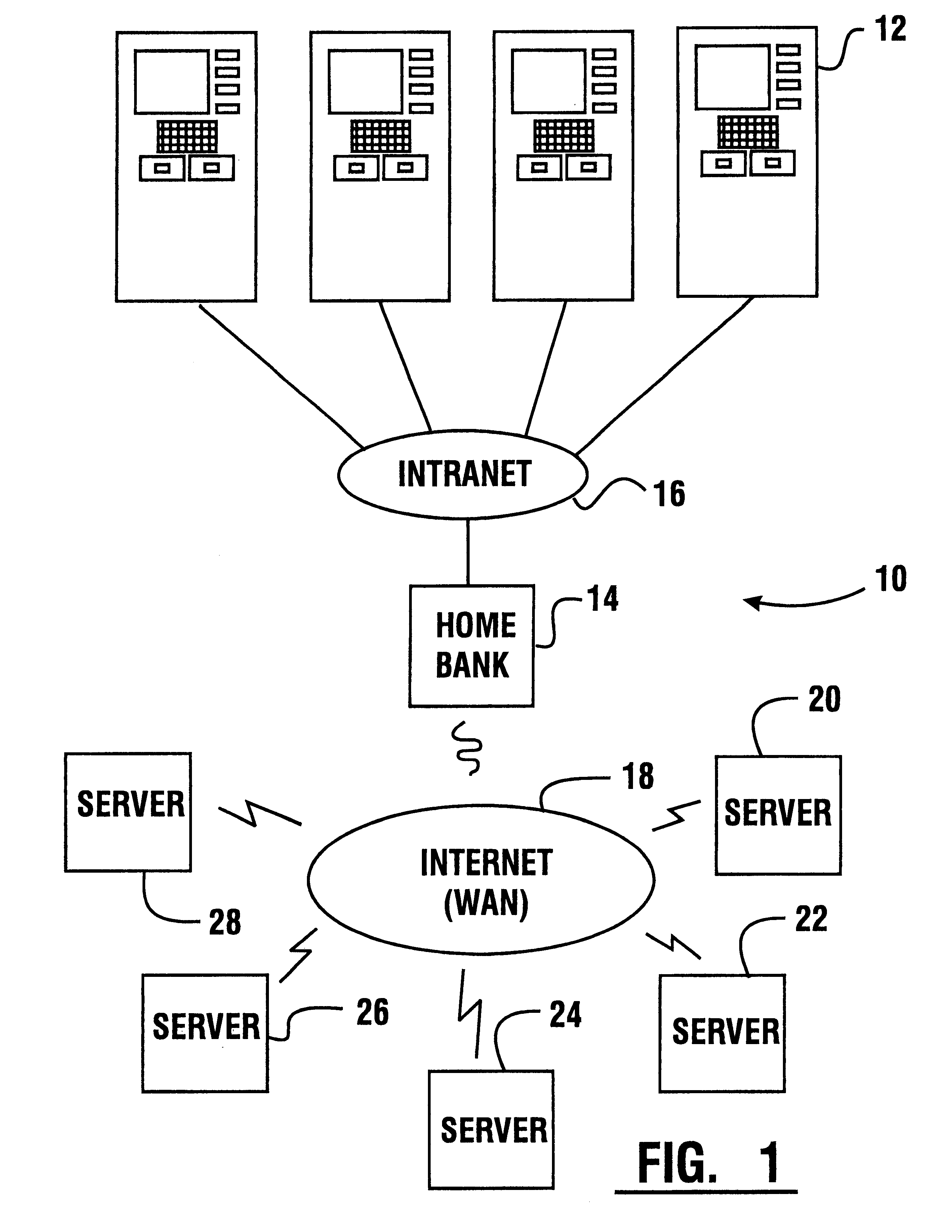

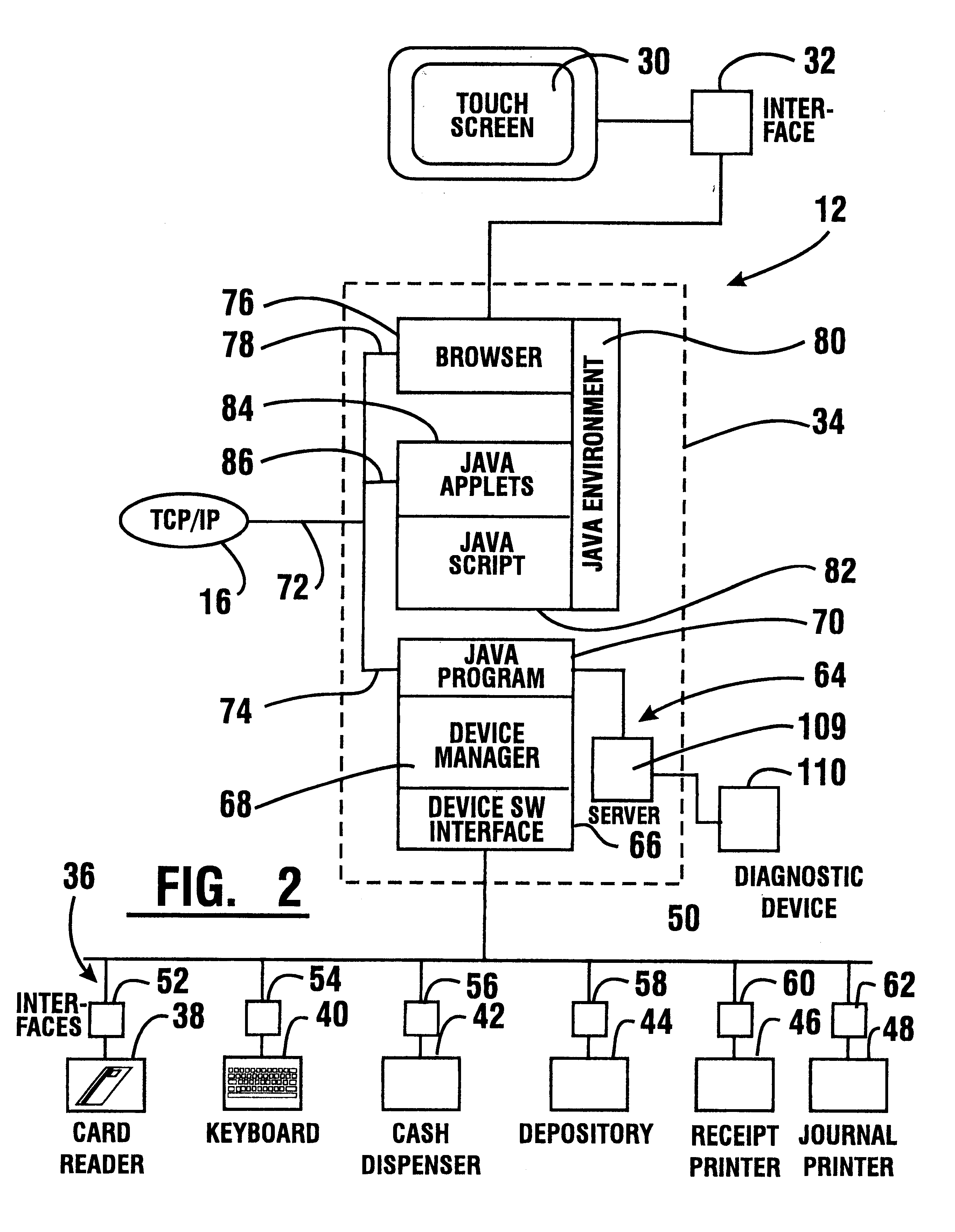

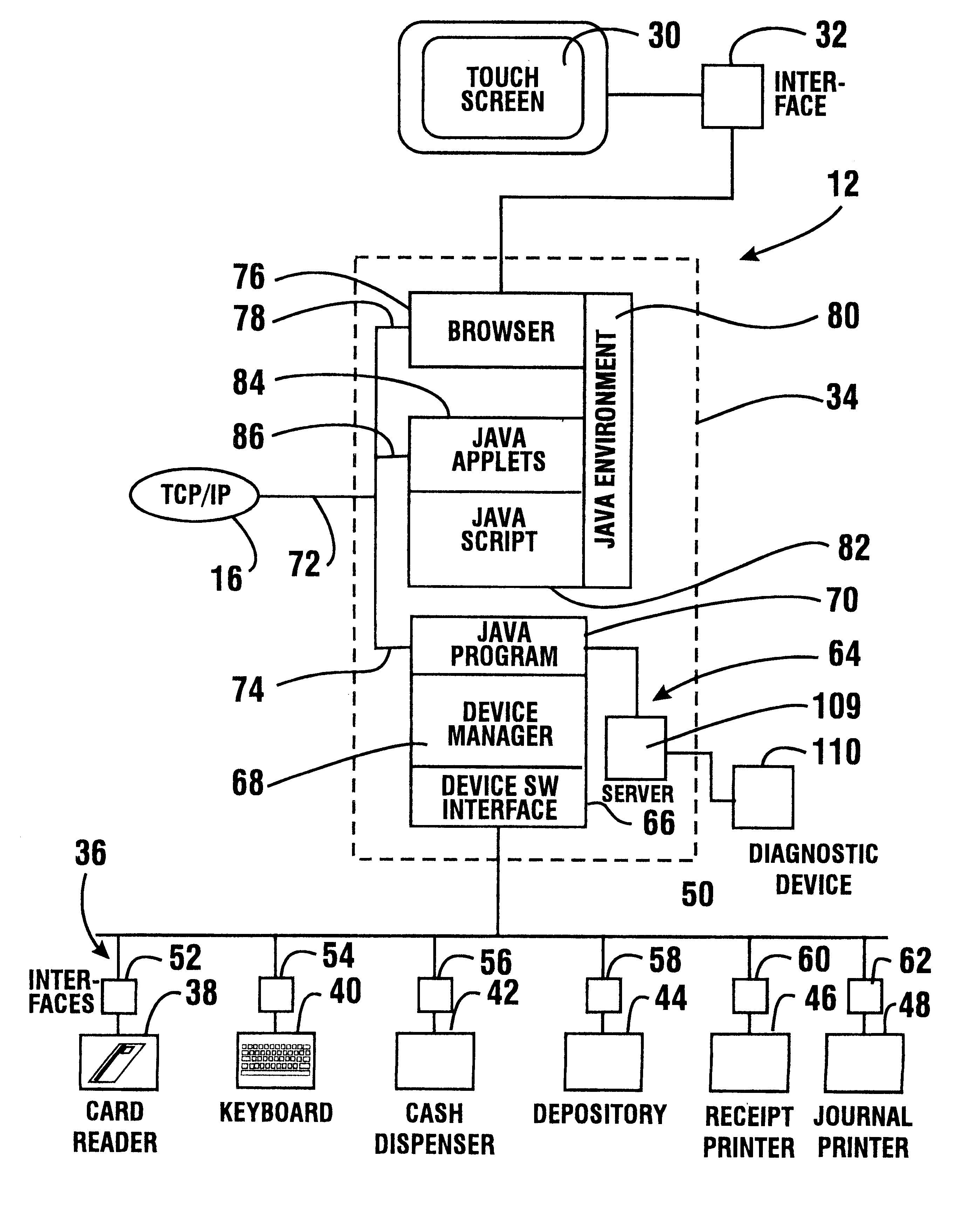

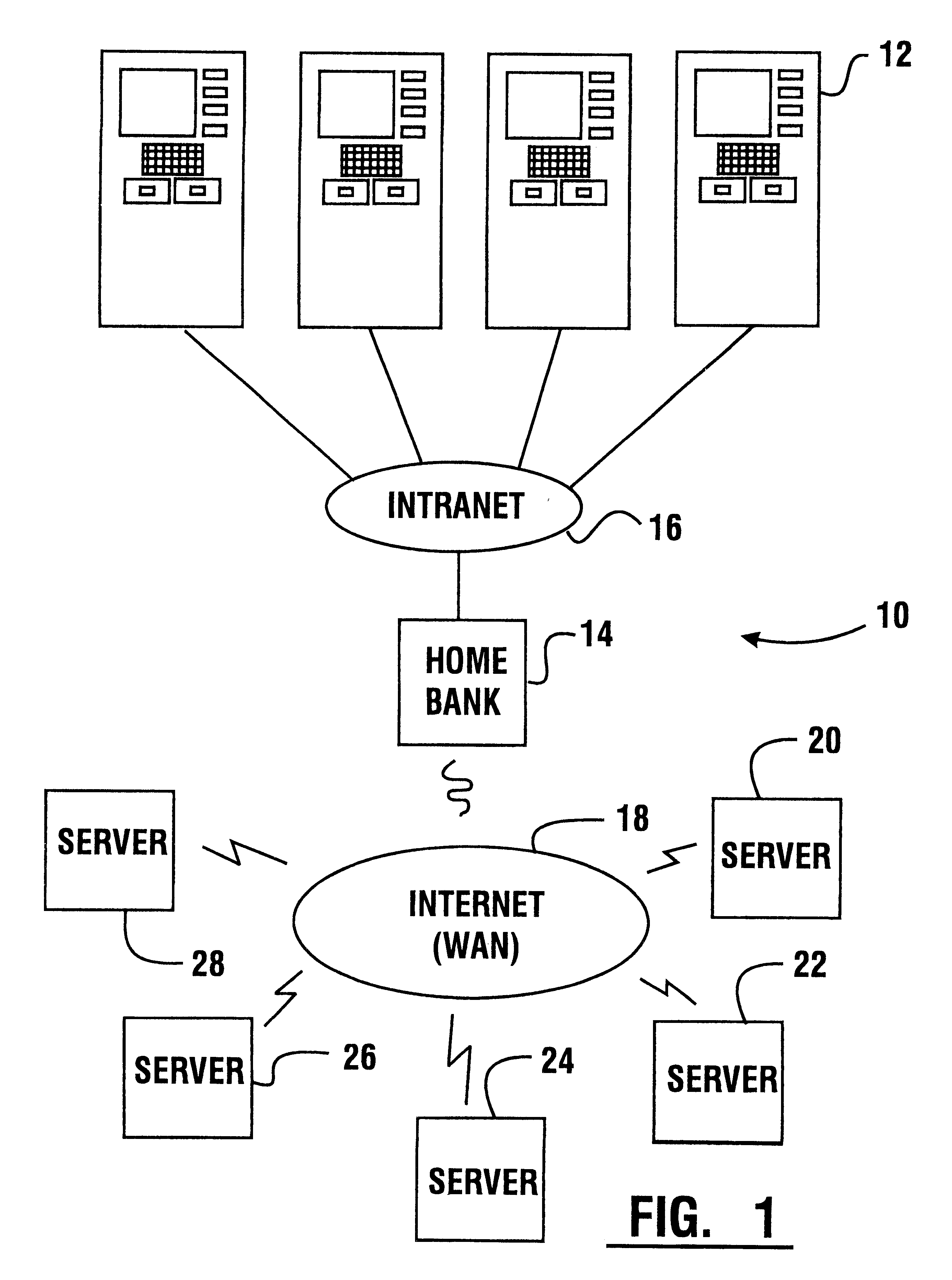

Automated banking machine apparatus and system

InactiveUS6289320B1Easy to operateMaintain securityPayment architectureSpecial data processing applicationsDocument handlingApplication software

An automated banking machine (12) is operative to conduct transactions in response to HTML documents and TCP / IP messages exchanged with a local computer system (14) through an intranet (16), as well as in response to messages exchanged with foreign servers (20, 22, 24, 26, 28, 96) in a wide area network (18). The banking machine includes a computer (34) having an HTML document handling portion (76, 80, 82). The HTML document handling portion is operative to communicate through a proxy server (88), with a home HTTP server (90) in the intranet or the foreign servers in the wide area network. The computer further includes a device application portion (84) which interfaces with the HTML document handling portion and dispatches messages to operate devices (36) in the automated banking machine. The devices include a sheet dispenser mechanism (42) which dispenses currency as well as other transaction devices. The device application portion communicates with a device interfacing software portion (64) in the banking machine through a device server (92) in the intranet. The device server maintains local control over the devices in the banking machine including the sheet dispenser. The banking machine operates to read indicia on the user's card corresponding to a system address. The computer is operative to connect the banking machine to the home or foreign server corresponding to the system address, which connected server operates the banking machine until the completion of transactions by the user.

Owner:DIEBOLD NIXDORF

Automated banking machine system and method

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

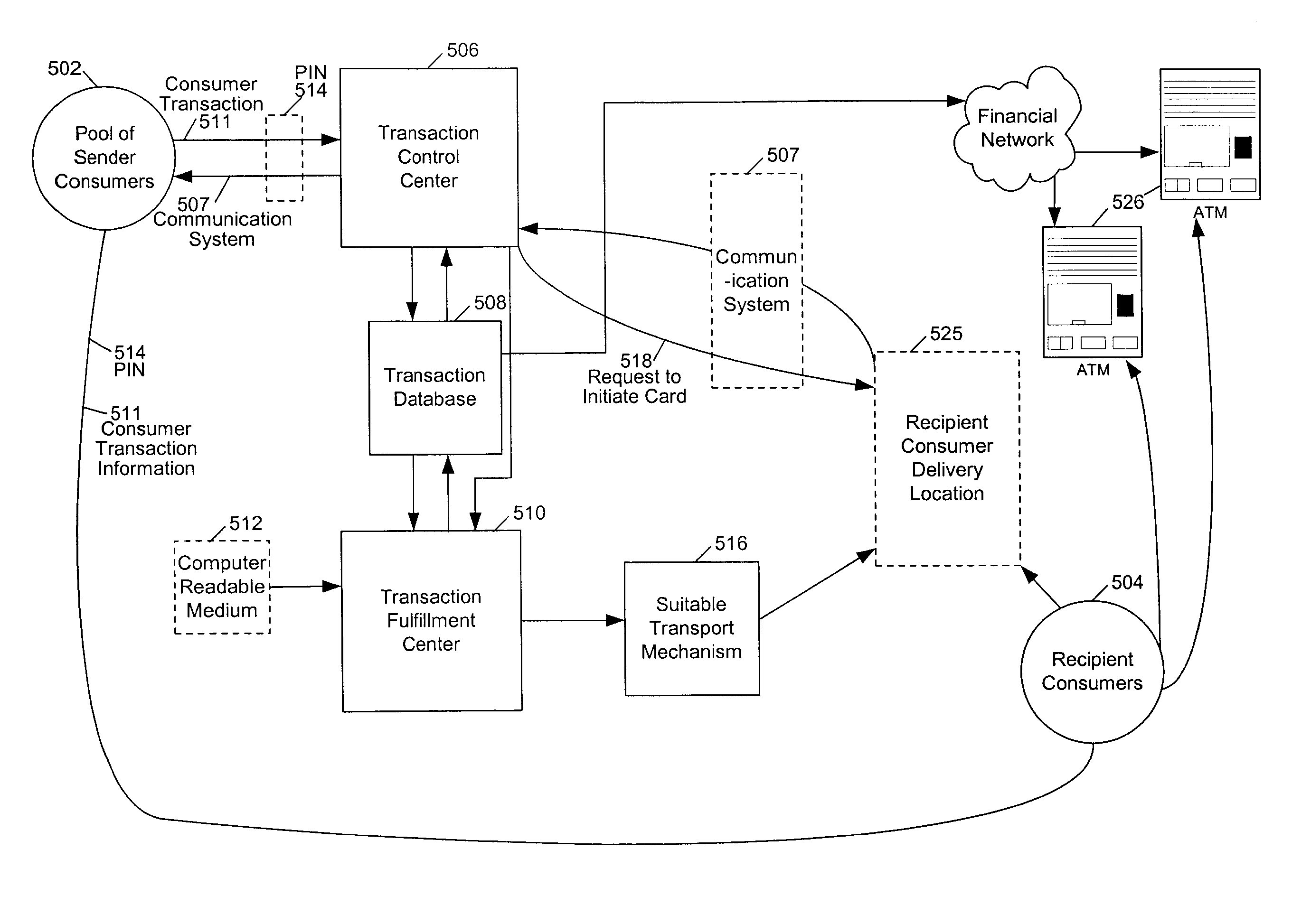

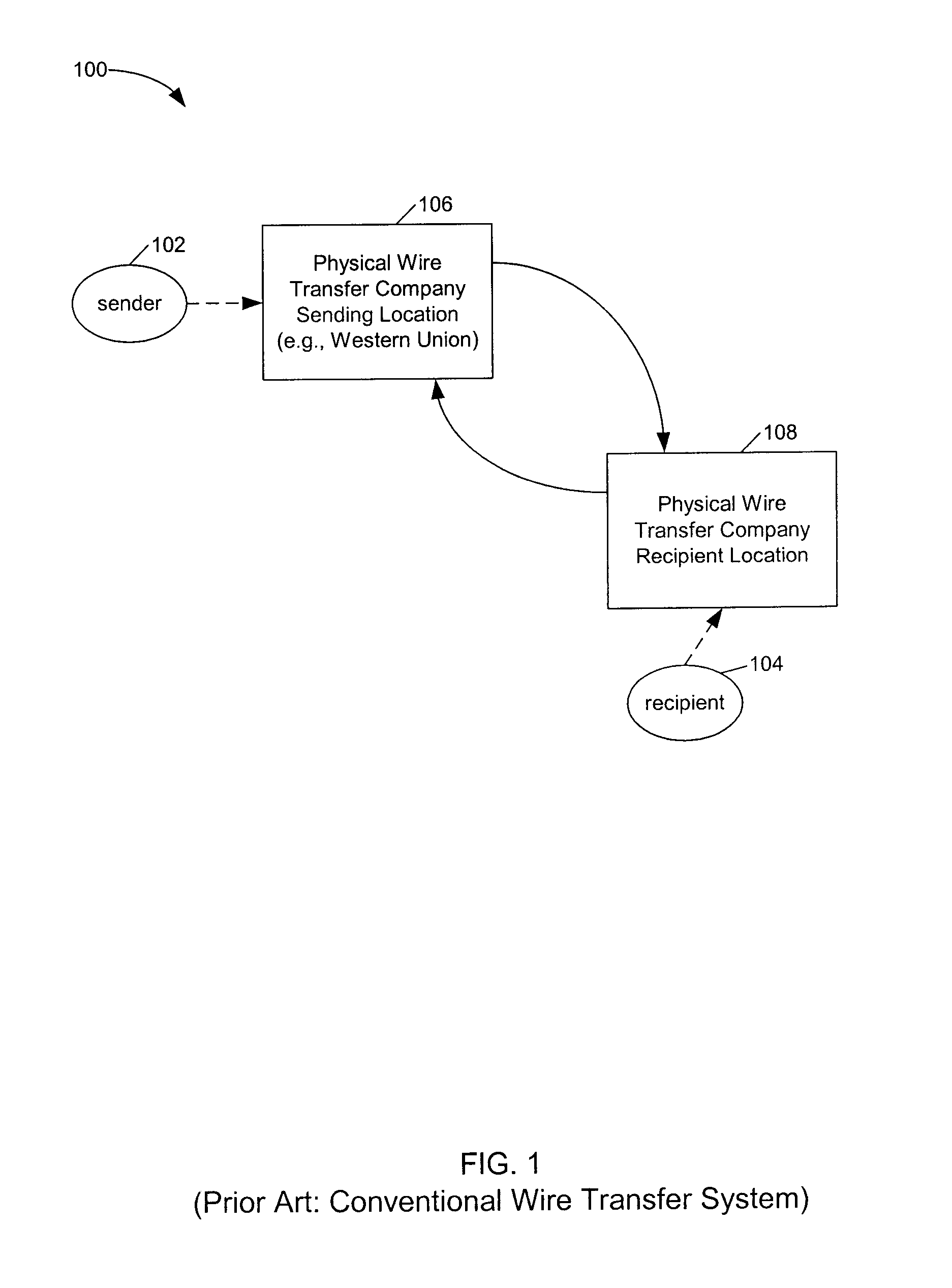

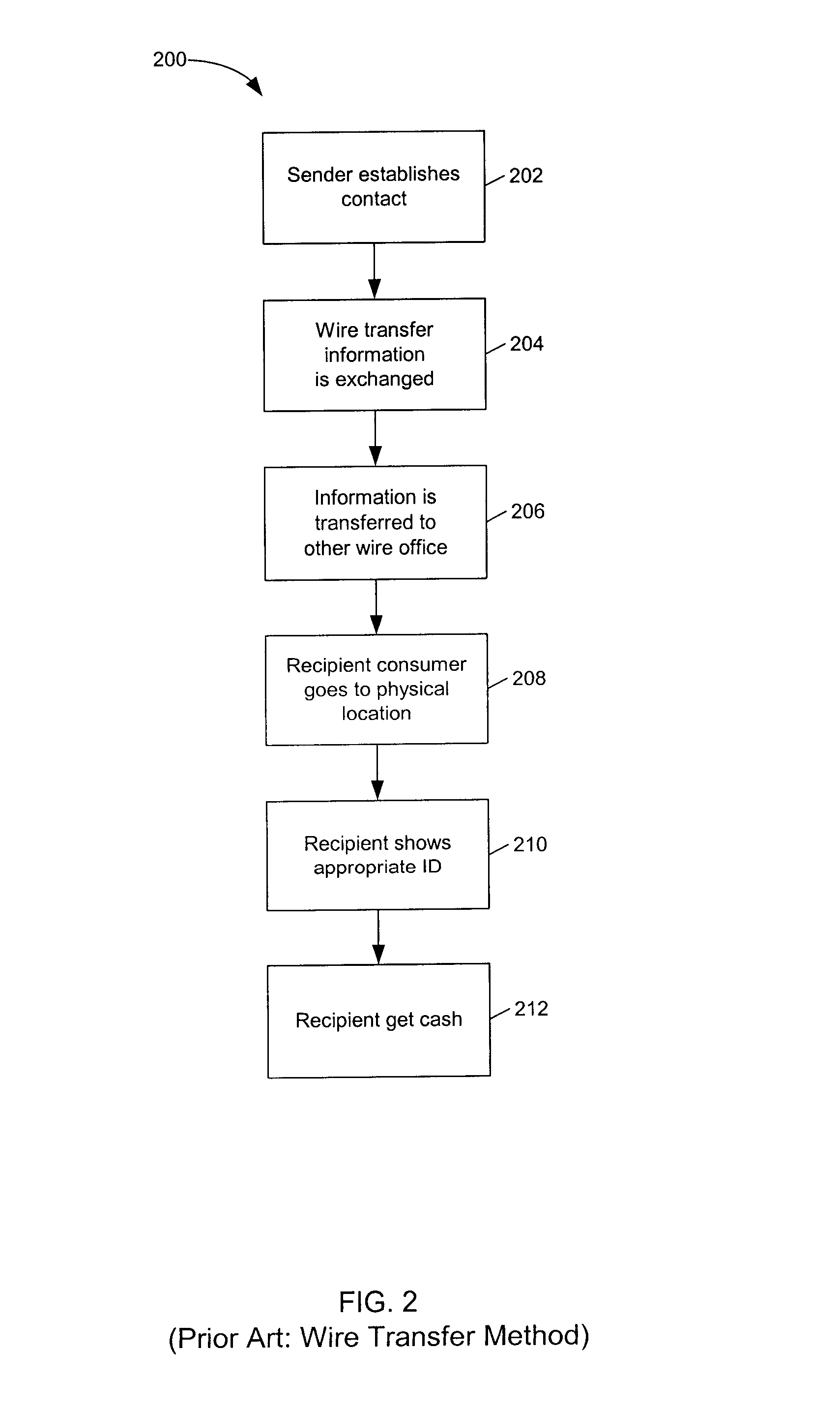

Improved money transfer system and method with added security features

InactiveUS20030028491A1Credit registering devices actuationATM softwaresThird partyComputerized system

<heading lvl="0">Abstract of Disclosure< / heading> Disclosed are improved computer systems and methods for money transfers completed by one-time use computer readable media for use in cash dispensing networks of computers (ATMs) as an alternative to a traditional wire transfer. In another embodiment a consumer may purchase these computer media at a third party location, which then allows the consumer to use it as portable electronic draft which substitutes for a traditional traveler 's check.

Owner:COOPER JONATHAN D

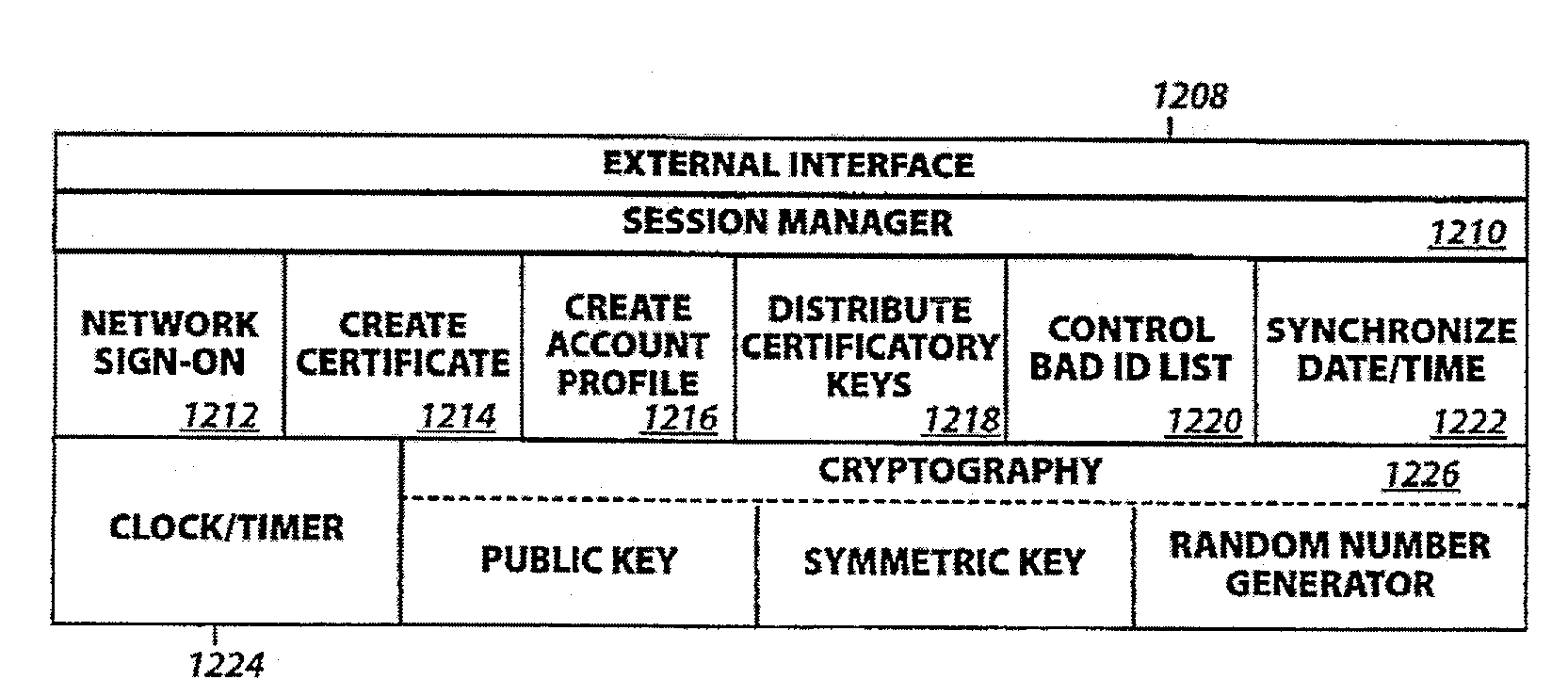

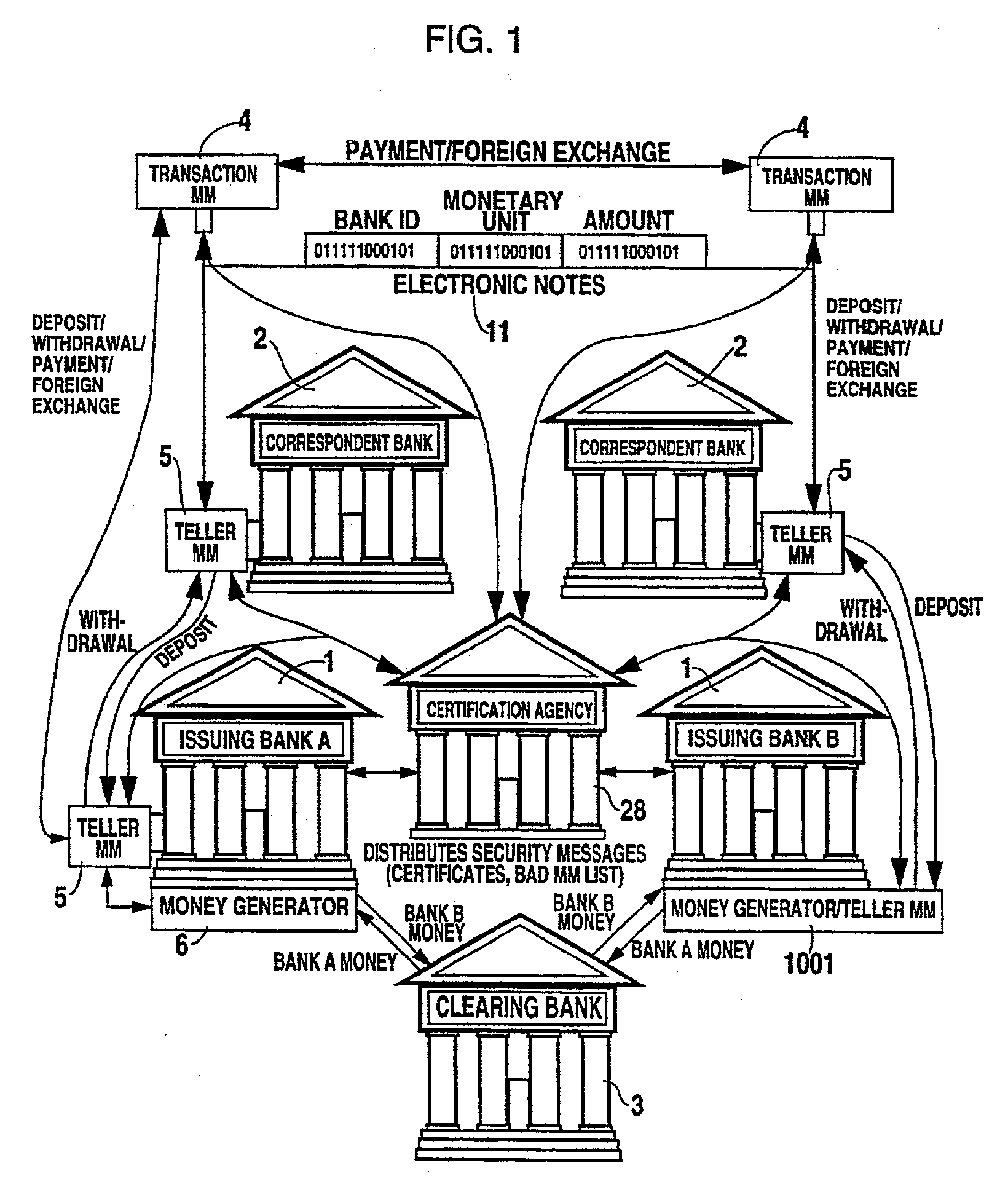

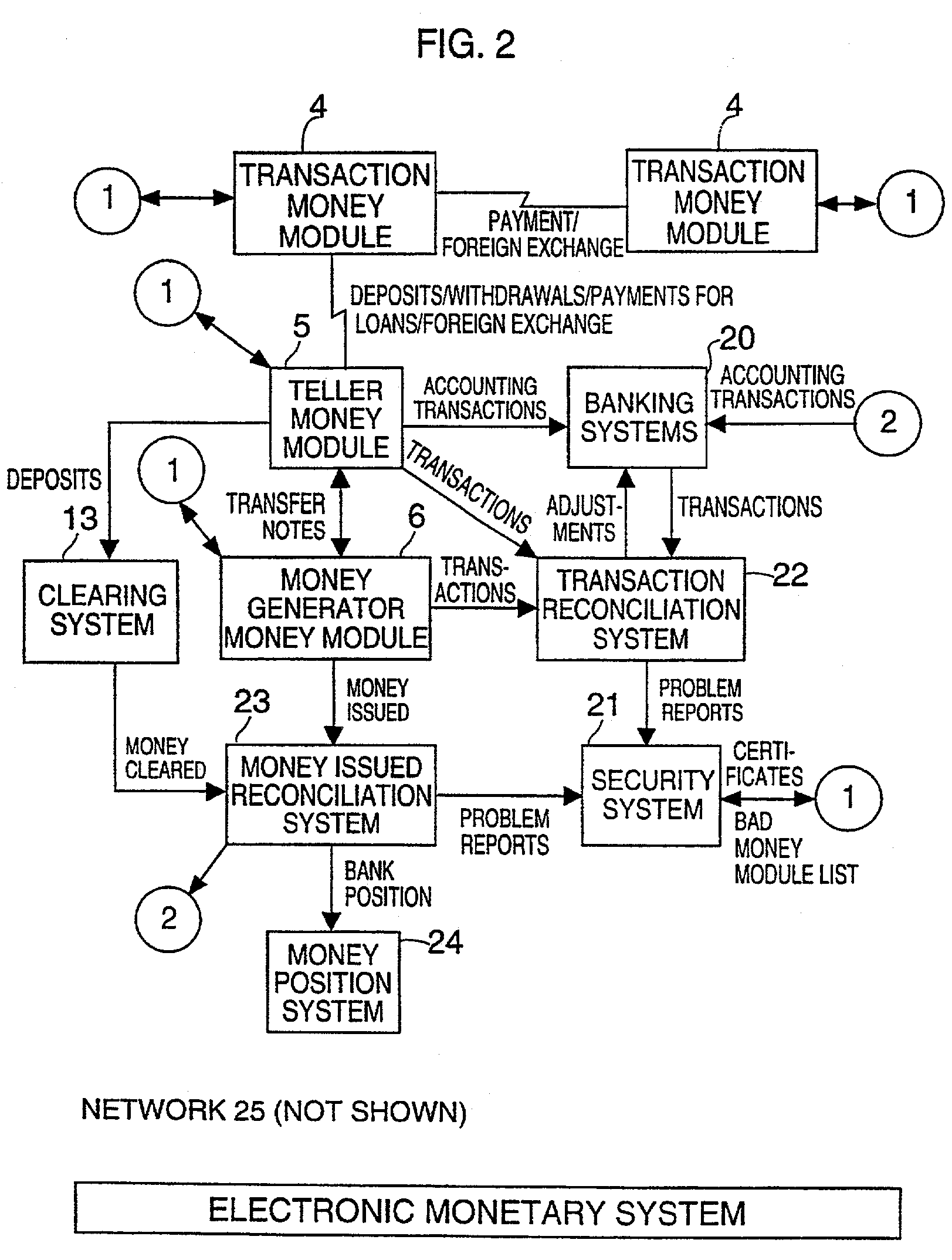

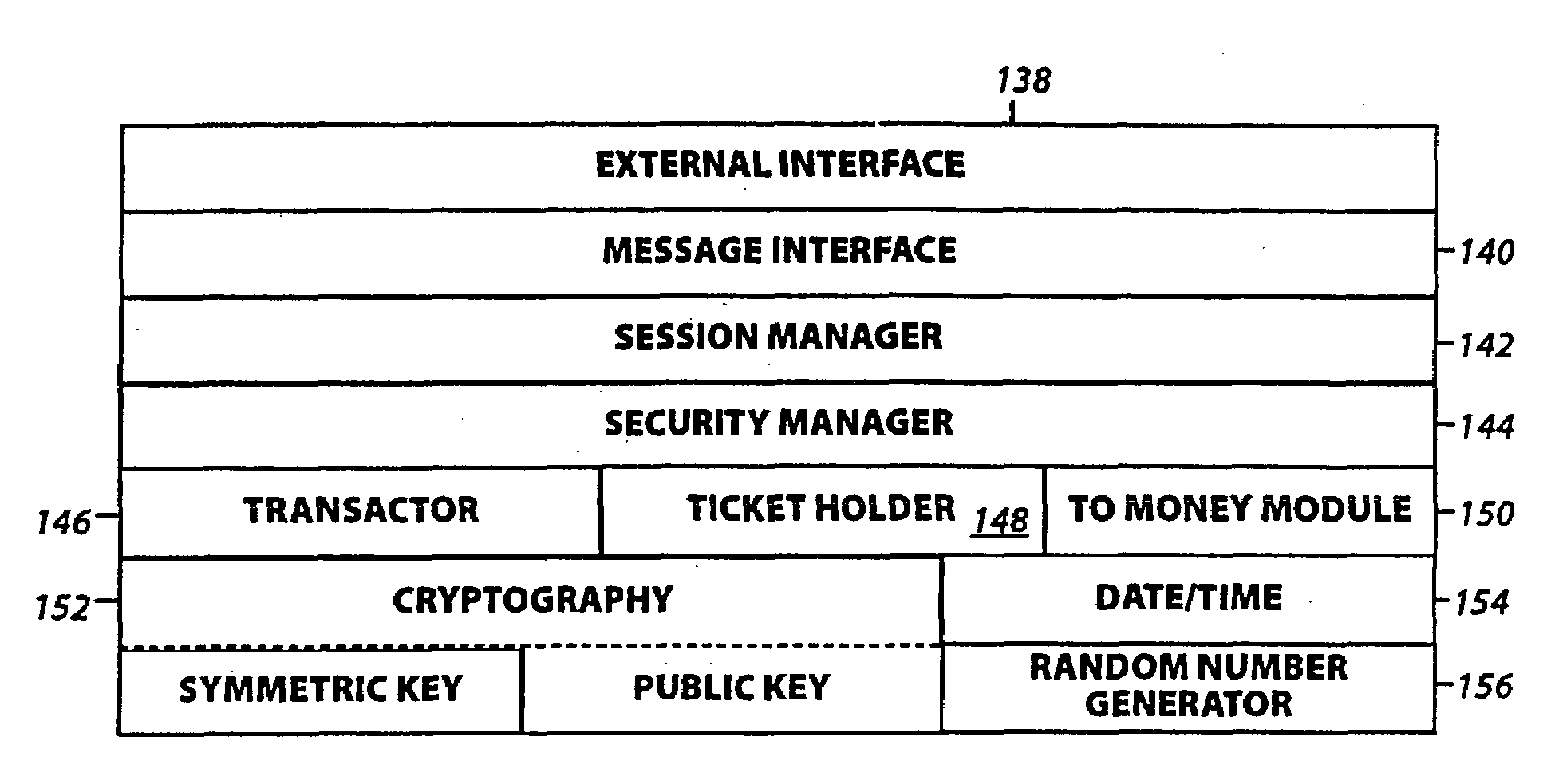

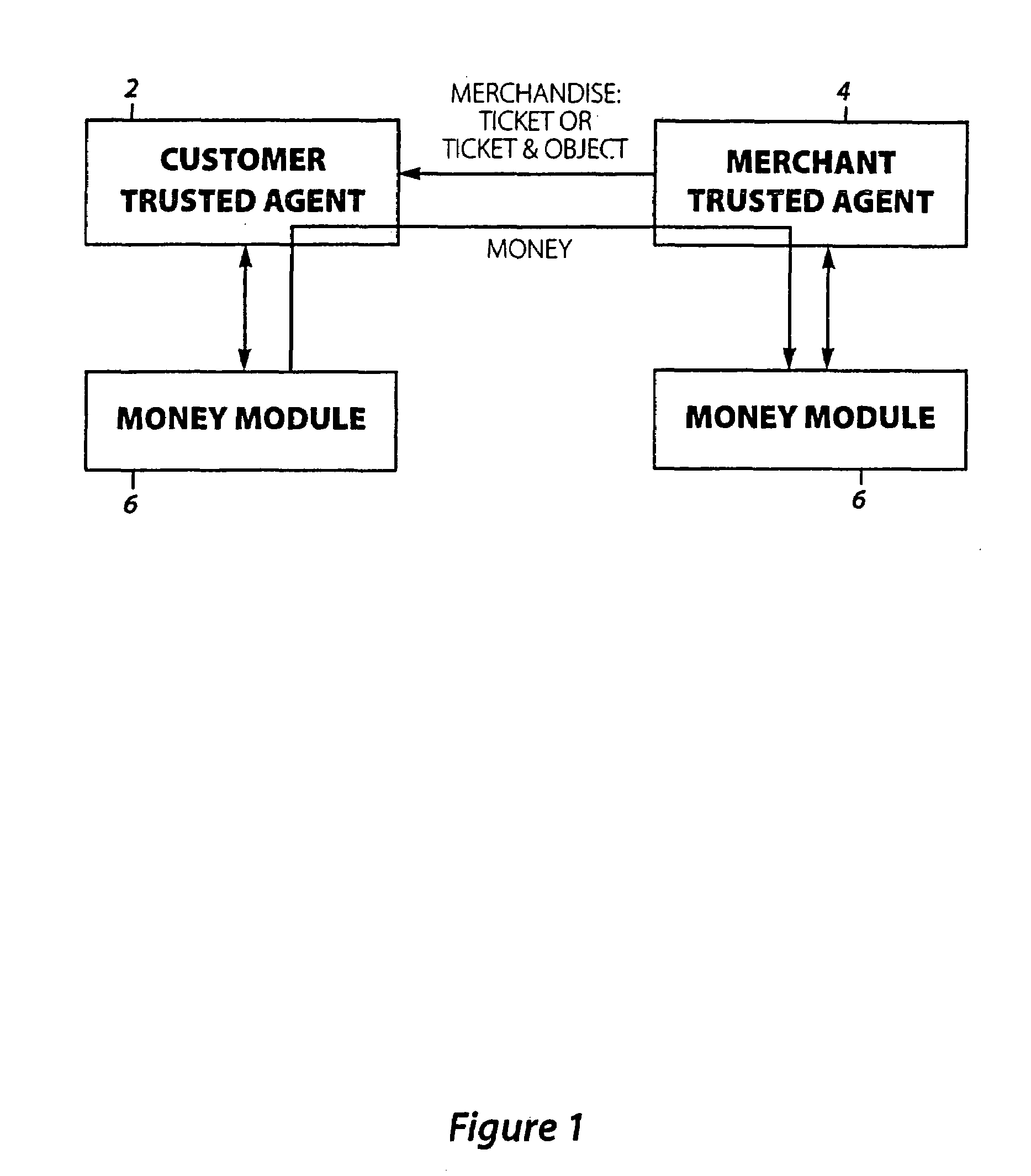

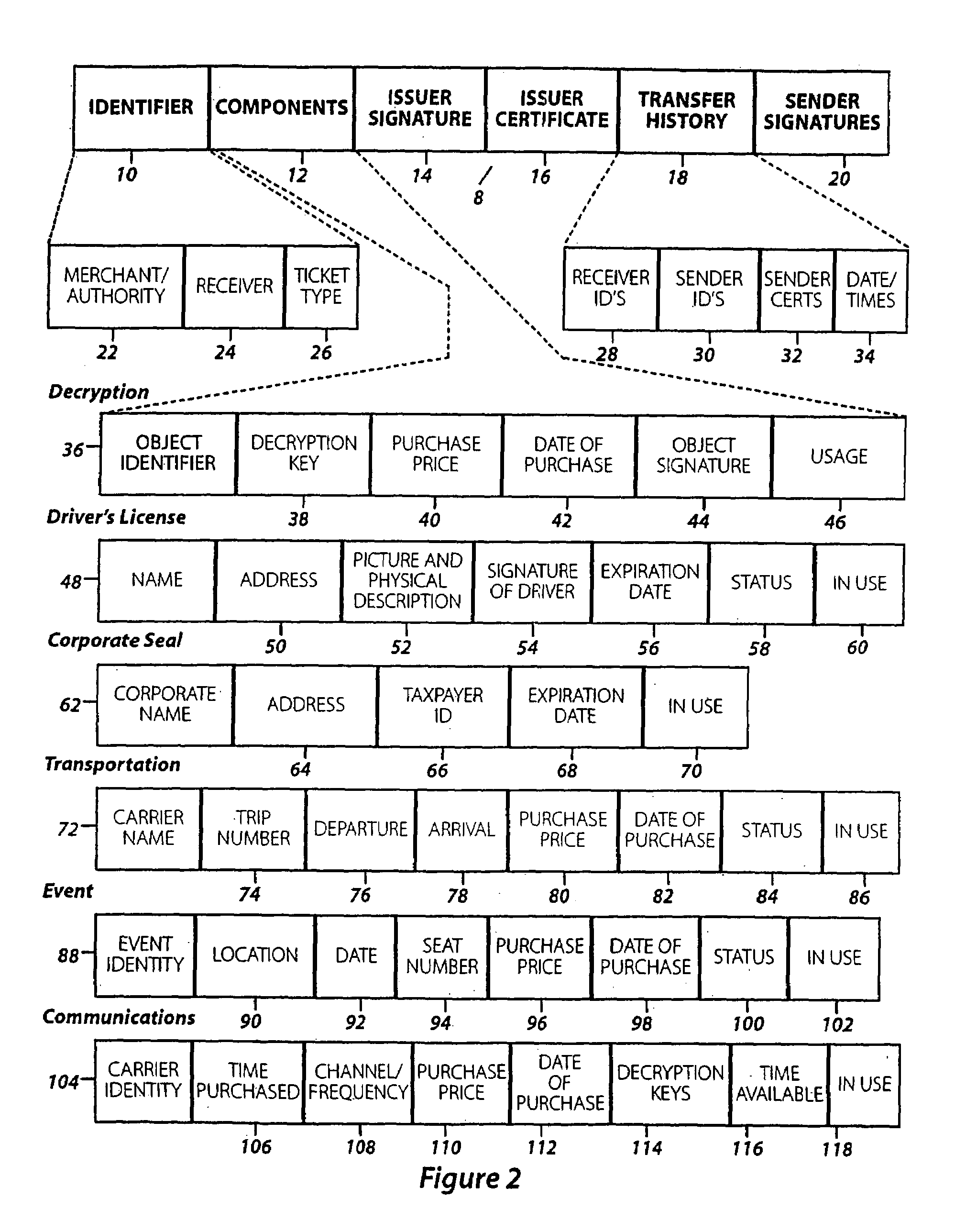

Electronic-monetary system

An improved monetary system using electronic media to exchange economic value securely and reliably is disclosed. The system provides a complete monetary system having electronic money that is interchangeable with conventional paper money. Also disclosed is a system for open electronic commerce having a customer trusted agent securely communicating with a first money module, and a merchant trusted agent securely communicating with a second money module. Both trusted agents are capable of establishing a first cryptographically secure session, and both money modules are capable of establishing a second cryptographically secure session. The merchant trusted agent transfers electronic merchandise to the customer trusted agent, and the first money module transfers electronic money to the second money module. The money modules inform their trusted agents of the successful completion of payment, and the customer may use the purchased electronic merchandise.

Owner:CITIBANK

Automated banking machine and system

InactiveUS6901382B1Good user interfaceFunction increasePayment architectureBilling/invoicingDocument handlingDocumentation

An automated banking machine (12) is operative to conduct transactions in response to HTML documents and TCP / IP messages exchanged with a local computer system (14) through an intranet (16), as well as in response to messages exchanged with foreign servers (20, 22, 24, 26, 28, 96) in a wide area network (18). The banking machine includes a computer (34) having an HTML document handling portion (76, 80, 82). The HTML document handling portion is operative to communicate through a proxy server (88), with a home HTTP server (90) in the intranet or the foreign servers in the wide area network. The computer further includes a device application portion (84) which interfaces with the HTML document handling portion and dispatches messages to operate devices (36) in the automated banking machine. The devices include a sheet dispenser mechanism (42) which dispenses currency as well as other transaction devices. The device application portion communicates with a device interfacing software portion (64) in the banking machine through a device server (92) in the intranet. The device server maintains local control over the devices in the banking machine including the sheet dispenser. The banking machine operates to read indicia on the user's card corresponding to a system address. The computer is operative to connect the banking machine to the home or foreign server corresponding to the system address, which connected server operates the banking machine until the completion of transactions by the user.

Owner:DIEBOLD NIXDORF

Automated banking machine and system

InactiveUS6334117B1Good user interfaceFunction increasePayment architectureBuying/selling/leasing transactionsDocument handlingProxy server

An automated banking machine (12) is operative to conduct transactions in response to HTML documents and TCP / IP messages exchanged with a local computer system (14) through an intranet (16), as well as in response to messages exchanged with foreign servers (20, 22, 24, 26, 28, 96) in a wide area network (18). The banking machine includes a computer (34) having an HTML document handling portion (76, 80, 82). The HTML document handling portion is operative to communicate through a proxy server (88), with a home HTTP server (90) in the intranet or the foreign servers in the wide area network. The computer further includes a device application portion (84) which interfaces with the HTML document handling portion and dispatches messages to operate devices (36) in the automated banking machine. The devices include a sheet dispenser mechanism (42) which dispenses currency as well as other transaction devices. The device application portion communicates with a device interfacing software portion (64) in the banking machine through a device server (92) in the intranet. The device server maintains local control over the devices in the banking machine including the sheet dispenser. The banking machine operates to read indicia on the user's card corresponding to a system address. The computer is operative to connect the banking machine to the home or foreign server corresponding to the system address, which connected server operates the banking machine until the completion of transactions by the user.

Owner:DIEBOLD NIXDORF

Electronic transaction apparatus for electronic commerce

A system for open electronic commerce having a customer trusted agent securely communicating with a first money module, and a merchant trusted agent securely communicating with a second money module. Both trusted agents are capable of establishing a first cryptographically secure session, and both money modules are capable of establishing a second cryptographically secure session. The merchant trusted agent transfers electronic merchandise to the customer trusted agent, and the first money module transfers electronic money to the second money module. The money modules inform their trusted agents of the successful completion of payment, and the customer may use the purchased electronic merchandise.

Owner:CITIBANK

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com