Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

317 results about "Electronic money" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

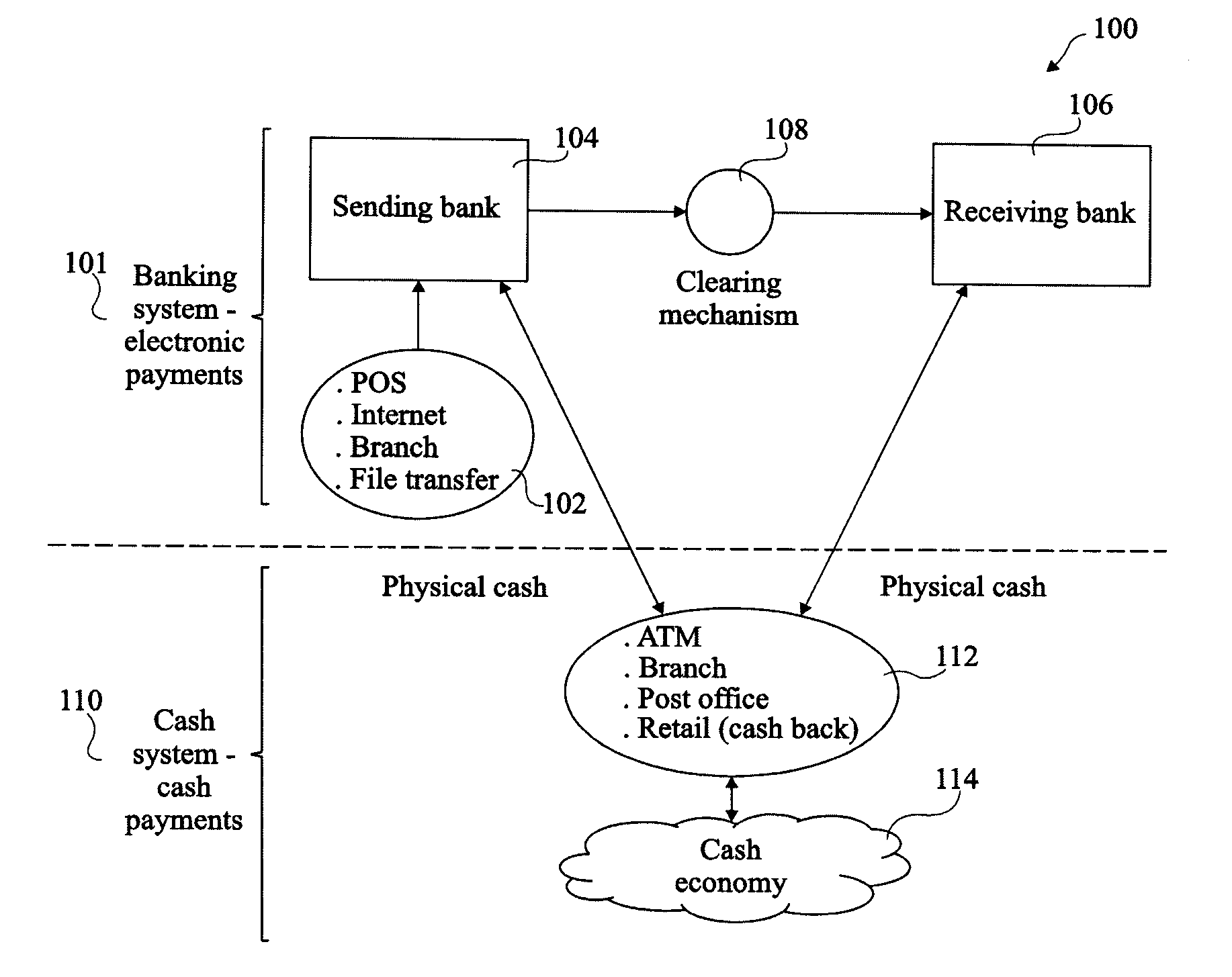

Inventor

Electronic money or e-money, is an evolving term that can have different meanings but in principle involves the use of computer networks and digital stored value systems to store and transmit money. It may have official legal status or not. It may be historical, current or theoretical. The underlying principle of electronic money involves the use of computer networks such as the Internet and digital stored value systems. Examples of electronic money are bank deposits, electronic funds transfer, direct deposit, payment processors, and digital currencies. Electronic money can be understood as a way of storing and transmitting conventional money through electronic systems or as digital currency which varies in value and is tradeable as a currency in its own right.

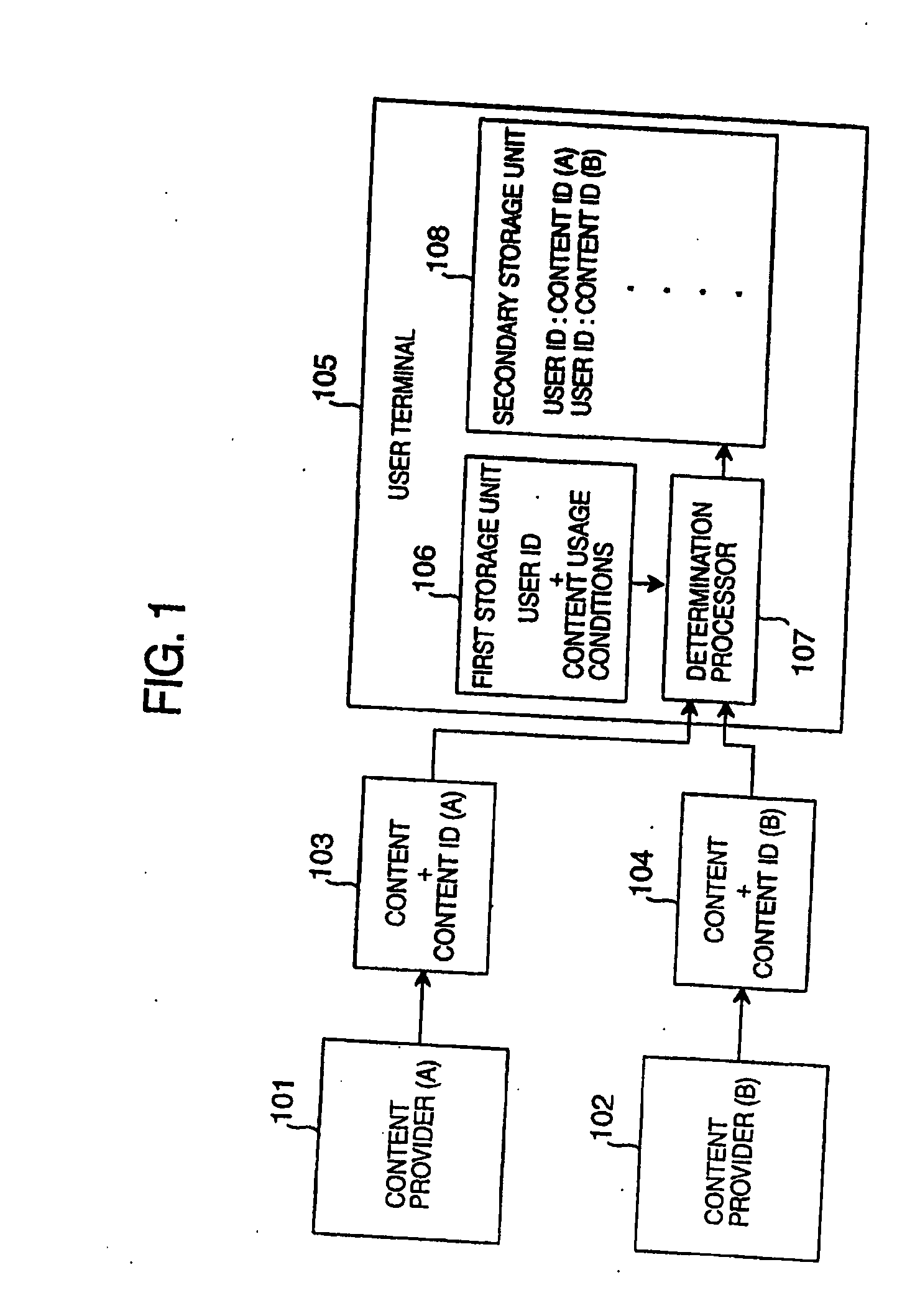

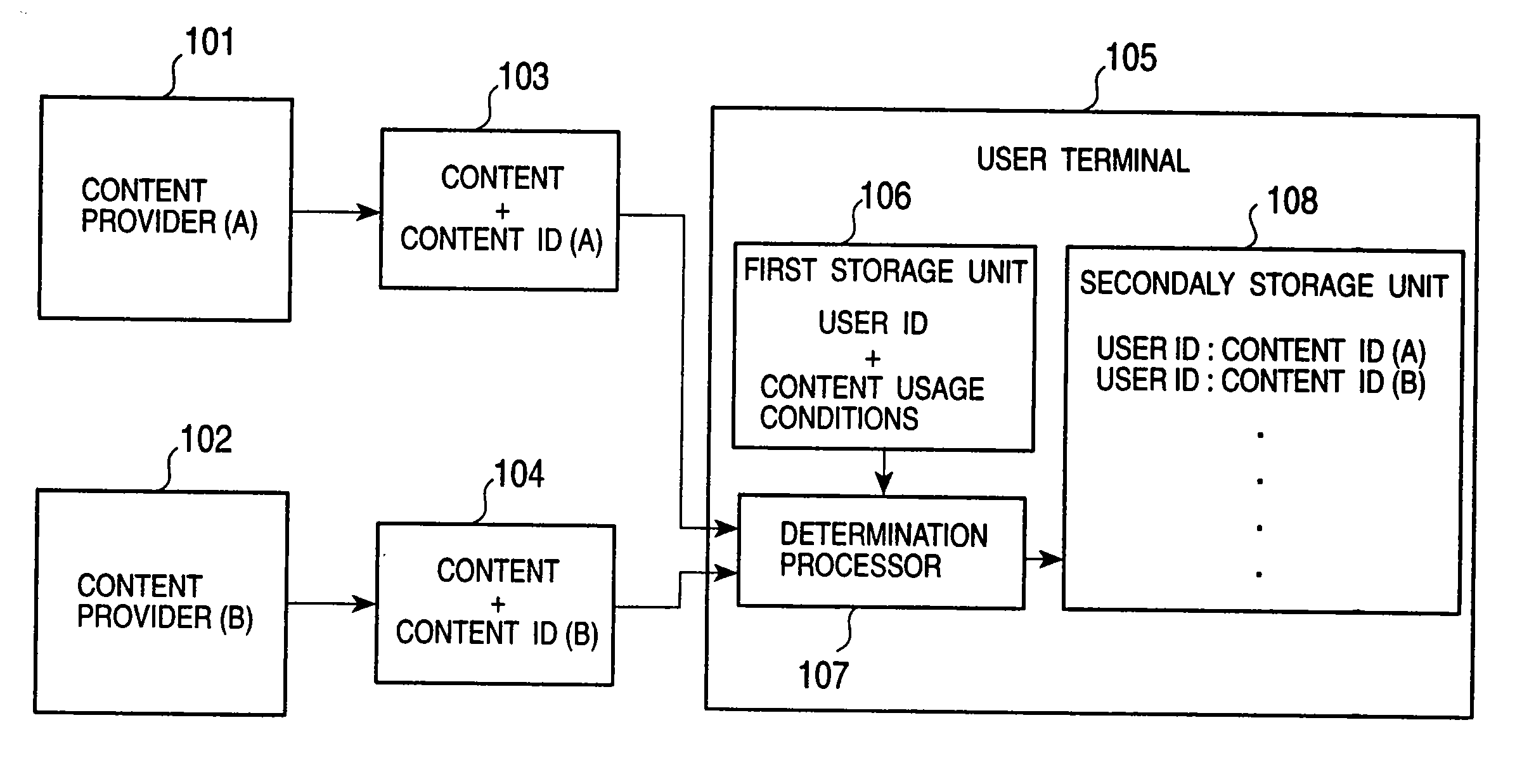

Content usage management system method, and program providing medium therefor

InactiveUS20060112016A1Transaction can be blockedAvoid distributingDiscounts/incentivesFinanceUser deviceService provision

When the encrypted content is provided from a service provider to a user device, a usage log including information of the content usage fee is created in the user device. The created usage log is then sent to the service provider. The service provider compares the content usage fee in the received usage log with a predetermined threshold. If the content usage fee is found to exceed the predetermined threshold, the service provider requests a clearing center to inquire about the electronic money balance of the user. If it is determined that it seems difficult to collect money from the user, the transmission of a content key to the user is suspended. The clearing center also creates an issue log in which the effective period and an allowable amount of money spent by the user are set, and performs settlement processing only when the payment of the content usage fee has been made within the effective period.

Owner:SONY CORP

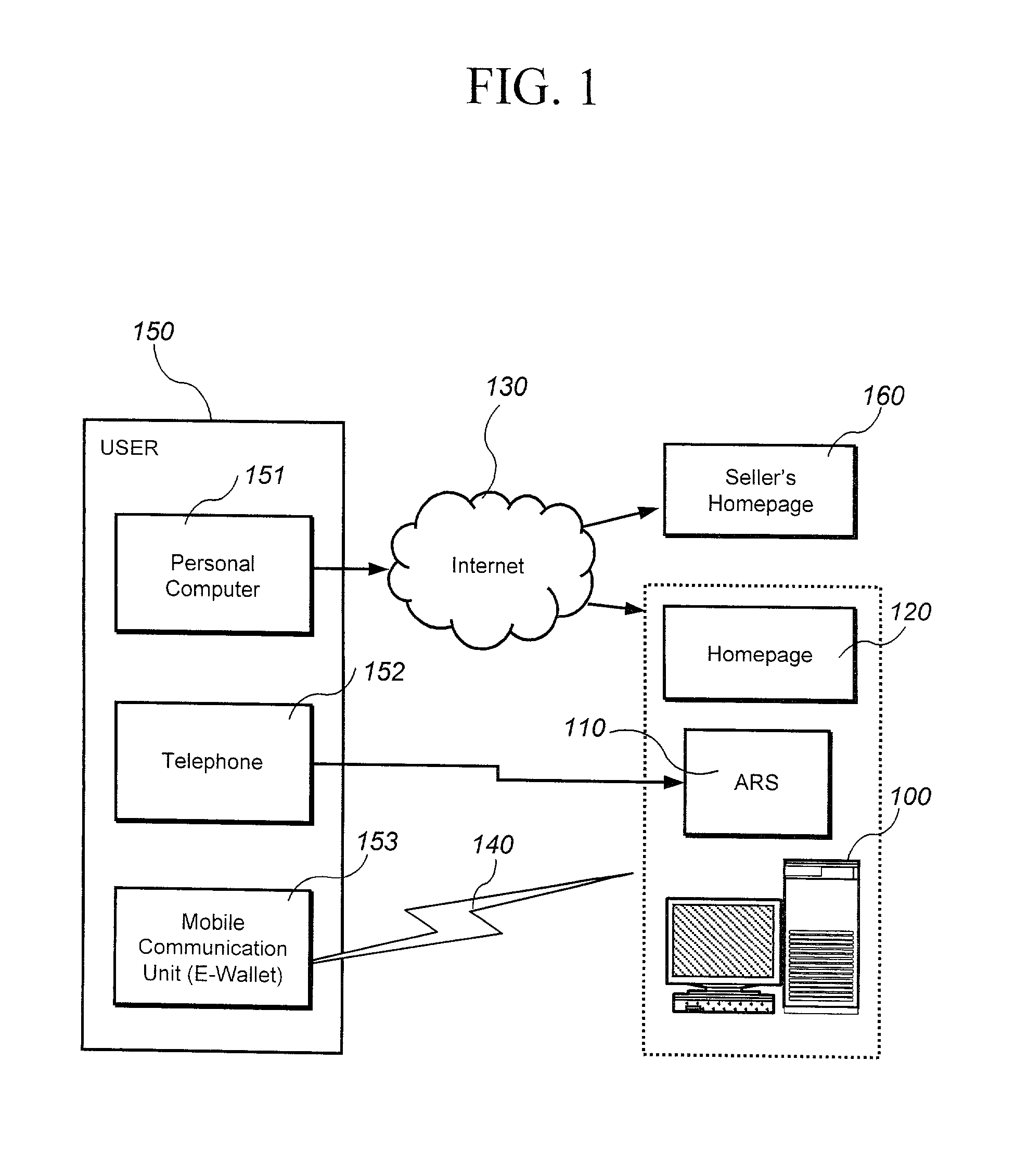

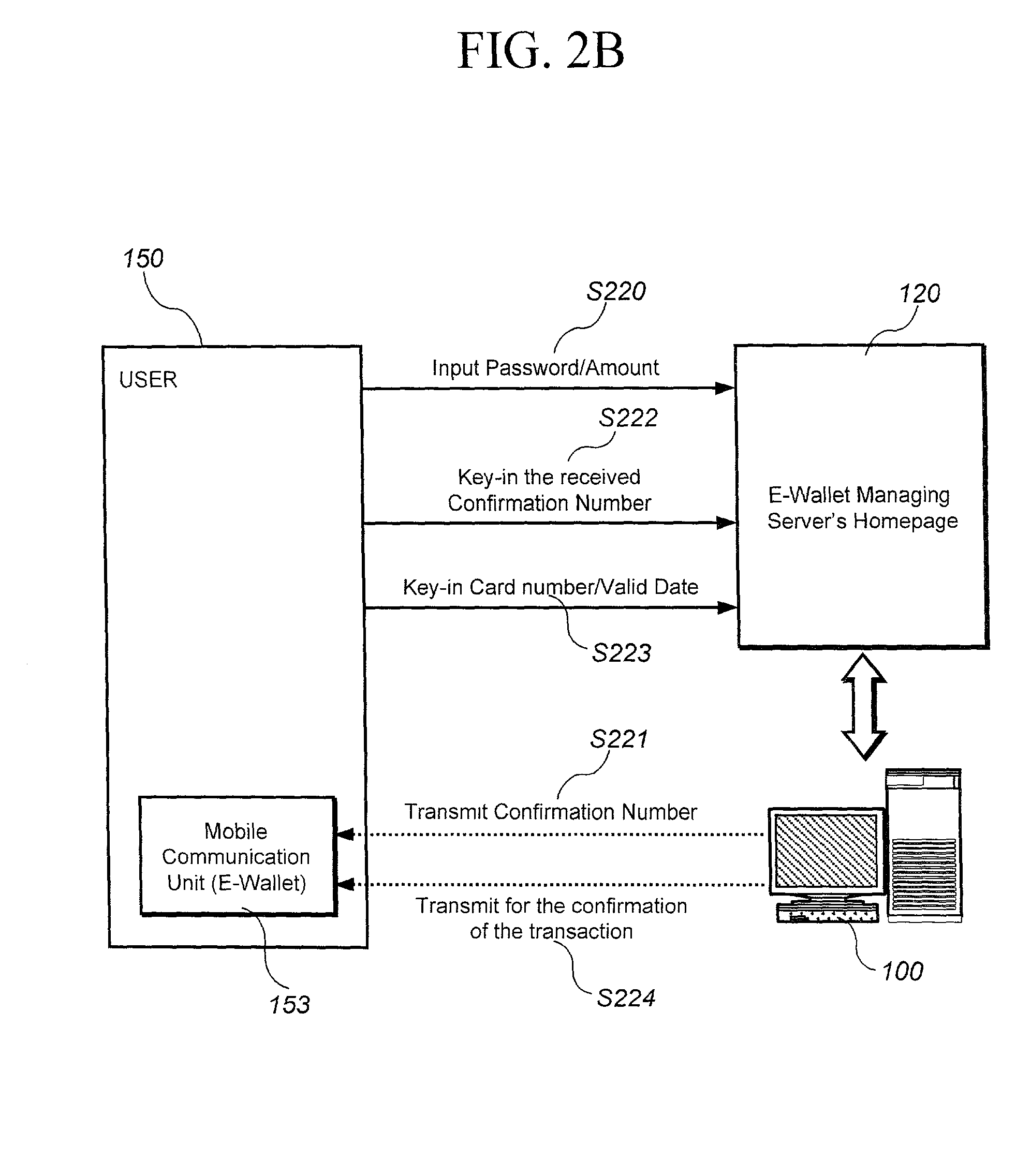

Method and system for transaction of electronic money with a mobile communication unit as an electronic wallet

InactiveUS20010007983A1Performed conveniently and safelyFinancePayment protocolsCommunication unitComputer science

A electronic monetary system comprising a mobile communication unit as an electronic wallet for transactions including electronic payments, money transfer, and recharging the electronic account. The security of the electronic transactions is confirmed by circulating a confirmation number through a loop formed by an E-wallet managing server through the wireless network to the mobile communication unit of the user.

Owner:INFOHUB

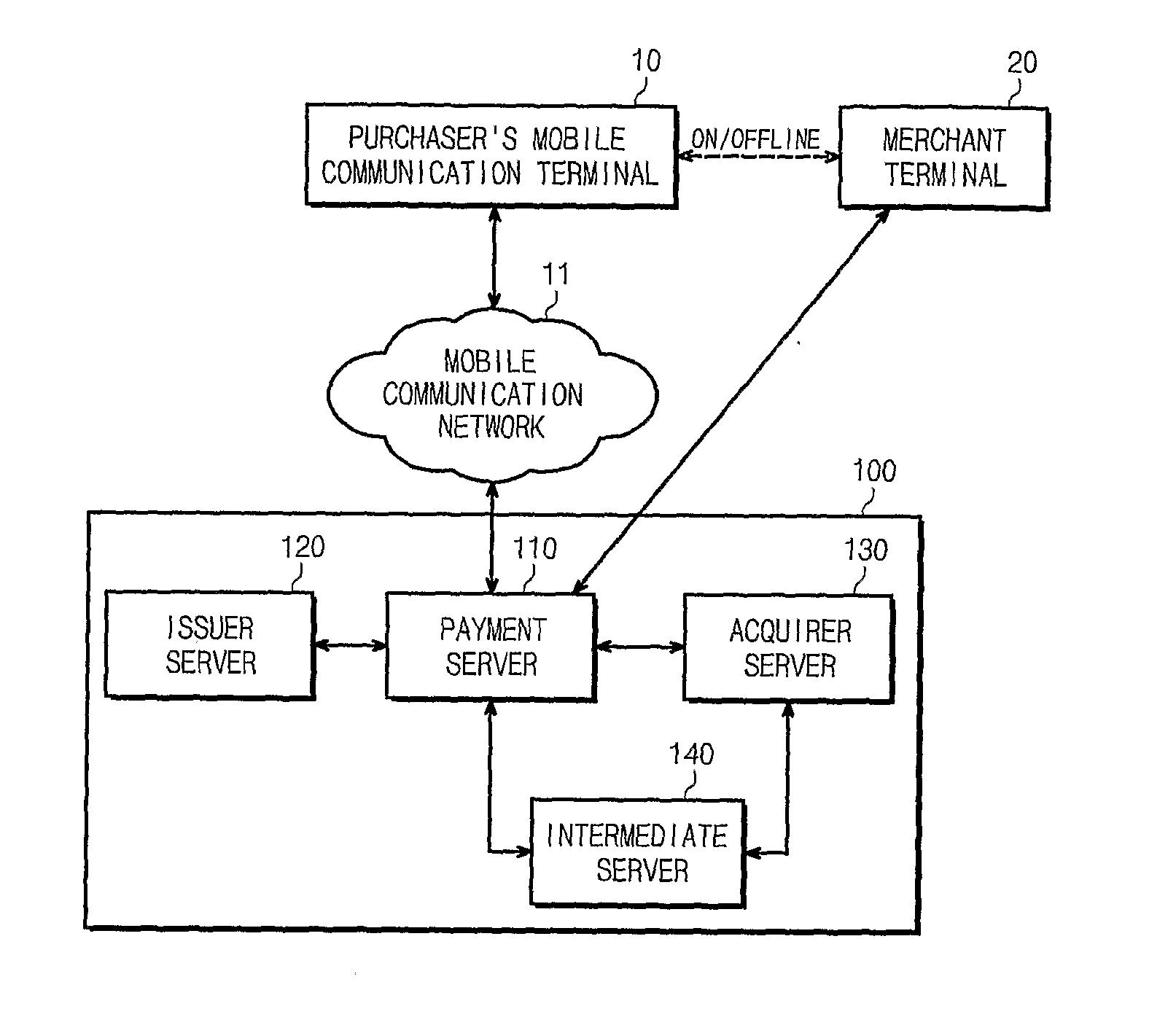

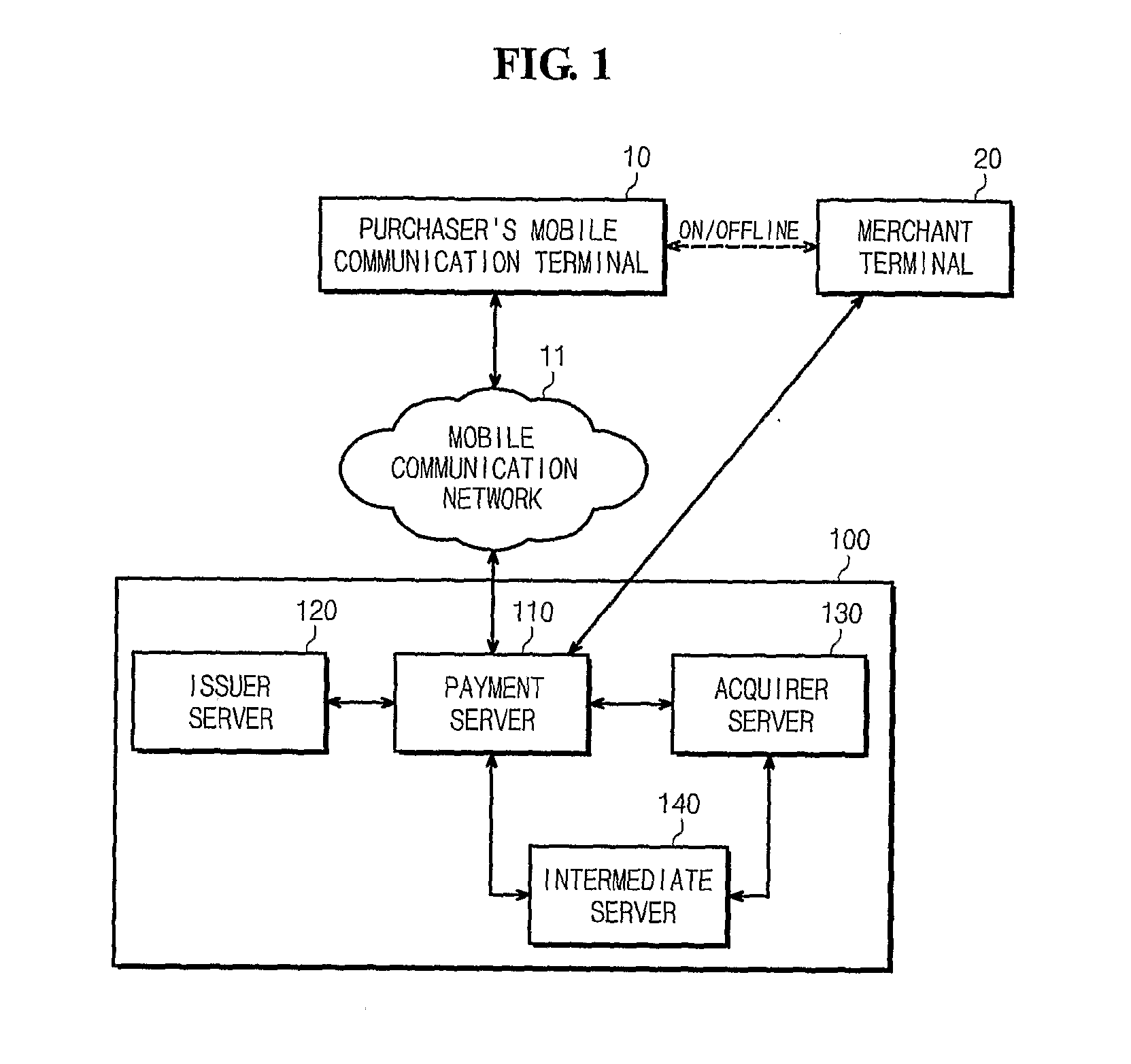

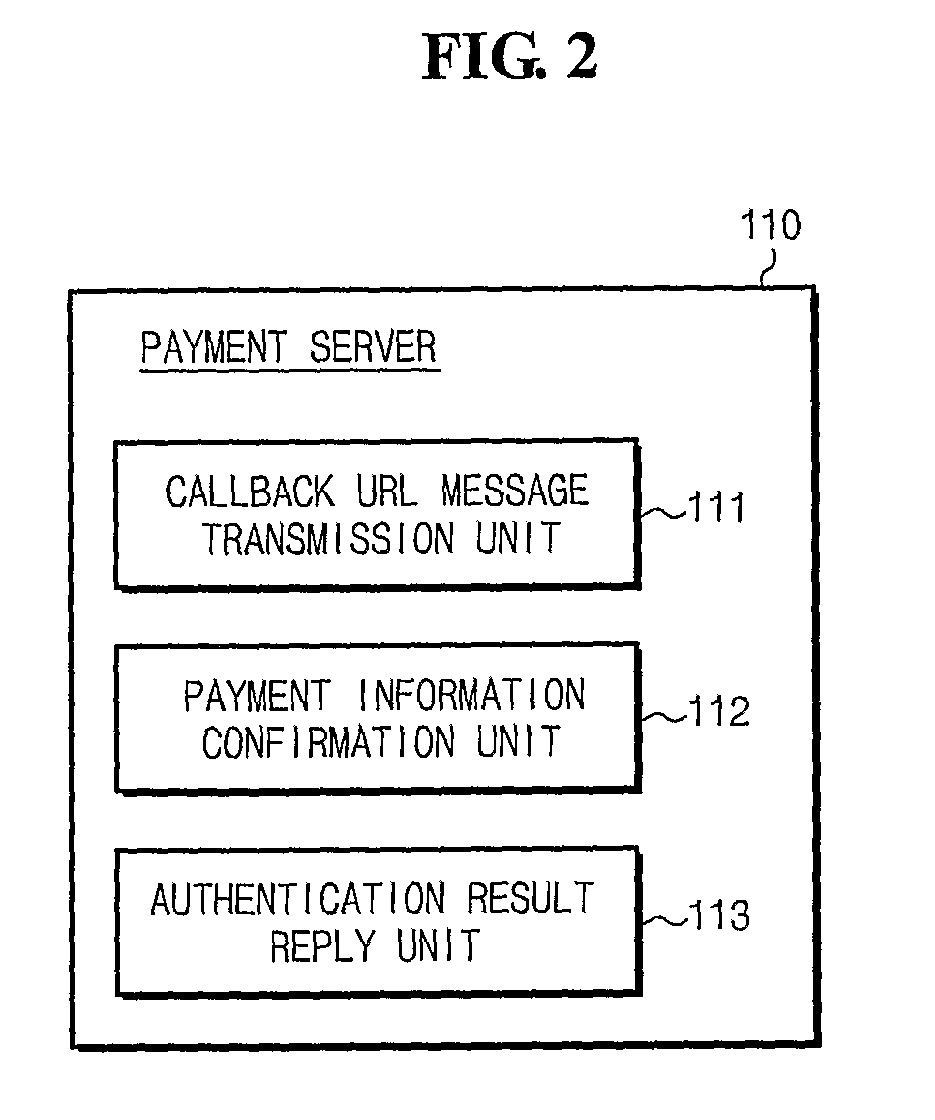

Authentication and Payment System and Method Using Mobile Communication Terminal

InactiveUS20080189186A1Buying/selling/leasing transactionsPoint-of-sale network systemsCredit cardComputer terminal

Disclosed herein are an authentication and payment system and method. The authentication and payment system of the present invention includes an issuer server, an issuer information management intermediate server, an acquirer server and a payment server. The issuer server issues, manages and operates payment means. The issuer information management intermediate server manages URL information required to access domestic and foreign issuer servers. The acquirer server performs payment approval and performs acquisition and settlement for member stores. The payment server intermediates between the issuer server and the acquirer server to provide an authentication and payment service in response to a request from a terminal of the merchant. Accordingly, the present invention can provide a safe and convenient payment process with respect to payment means, such as credit cards, electronic money or mobile phone micro payment that can be selected between a purchaser and a merchant.

Owner:SK PLANET CO LTD

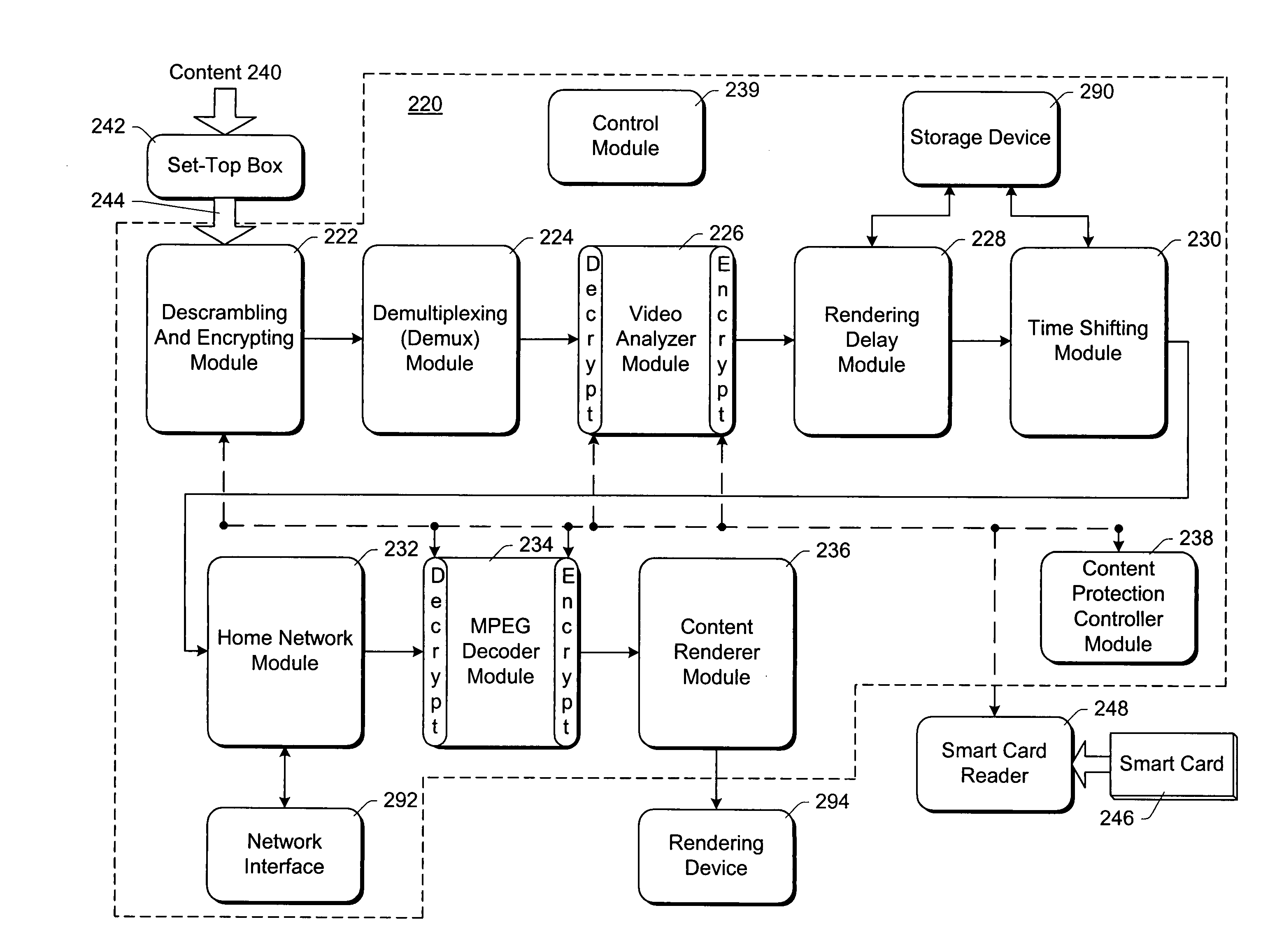

Enhancing smart card usage for associating media content with households

InactiveUS7124938B1Improve privacyEasy to changeAcutation objectsPayment architectureUser privacySmart card security

Various enhancements are made to using smart cards that are associated with (or to be associated with) a household. In one embodiment, data that is expected to be of value to a user (e.g., electronic money) is attached to that user's smart card(s), thereby providing an incentive for the user to keep his or her smart card(s) secure. In another embodiment, the smart cards are used for parental control (e.g., by restricting the children's access to one or more of the smart cards). In yet another embodiment, smart cards are used to enhance user privacy by maintaining user-specific information on the smart cards (which can be de-coupled from the computing device whenever the user desires). In another embodiment, the boundaries of a network of computing devices are defined by multiple smart cards—any computing device to which a smart card is coupled is part of the network.

Owner:MICROSOFT TECH LICENSING LLC

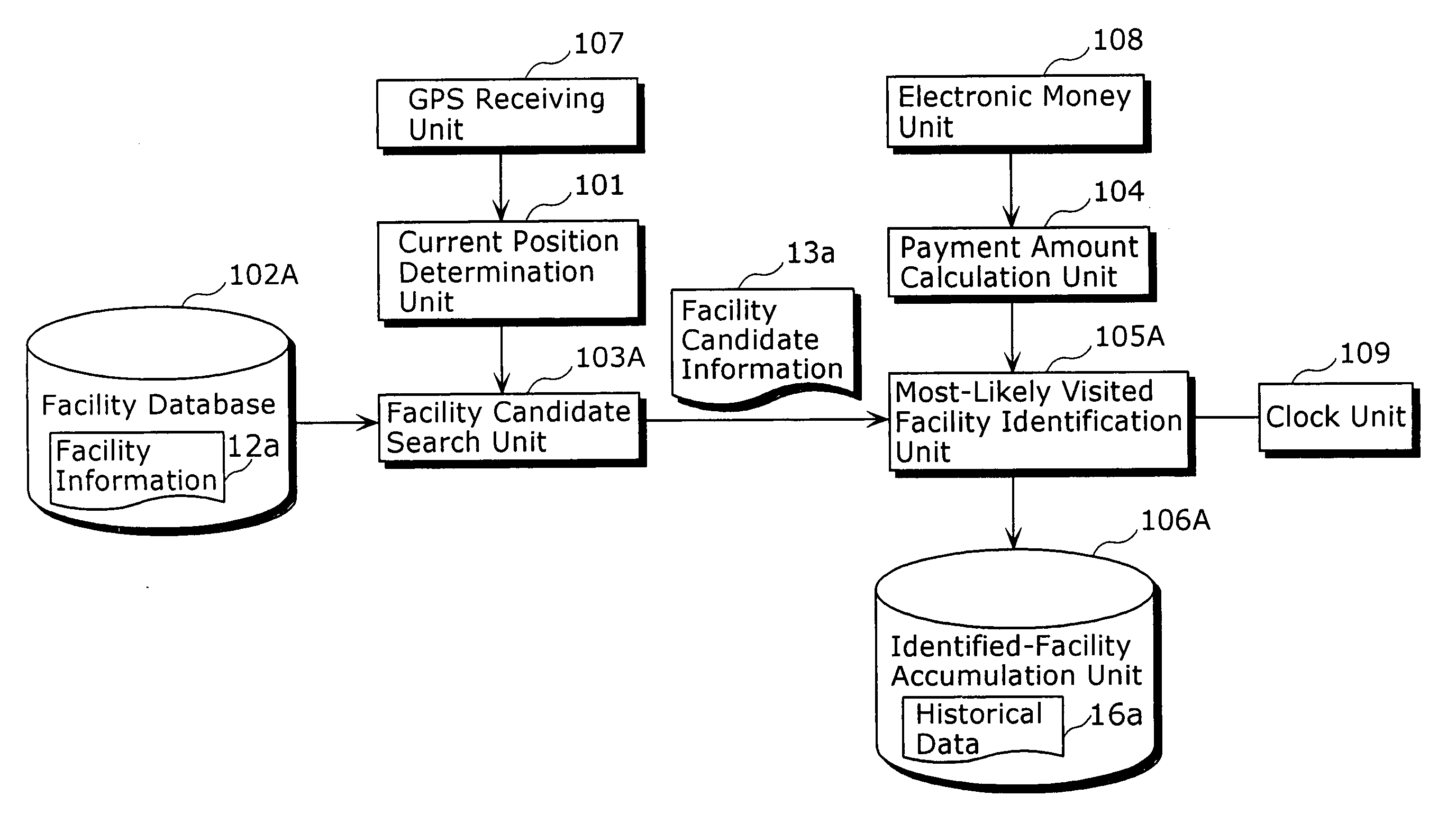

Visiting place identification device and visiting place identification method

ActiveUS20060149684A1Learn accuratelyInformation can be usedInstruments for road network navigationAcutation objectsEngineeringIdentification device

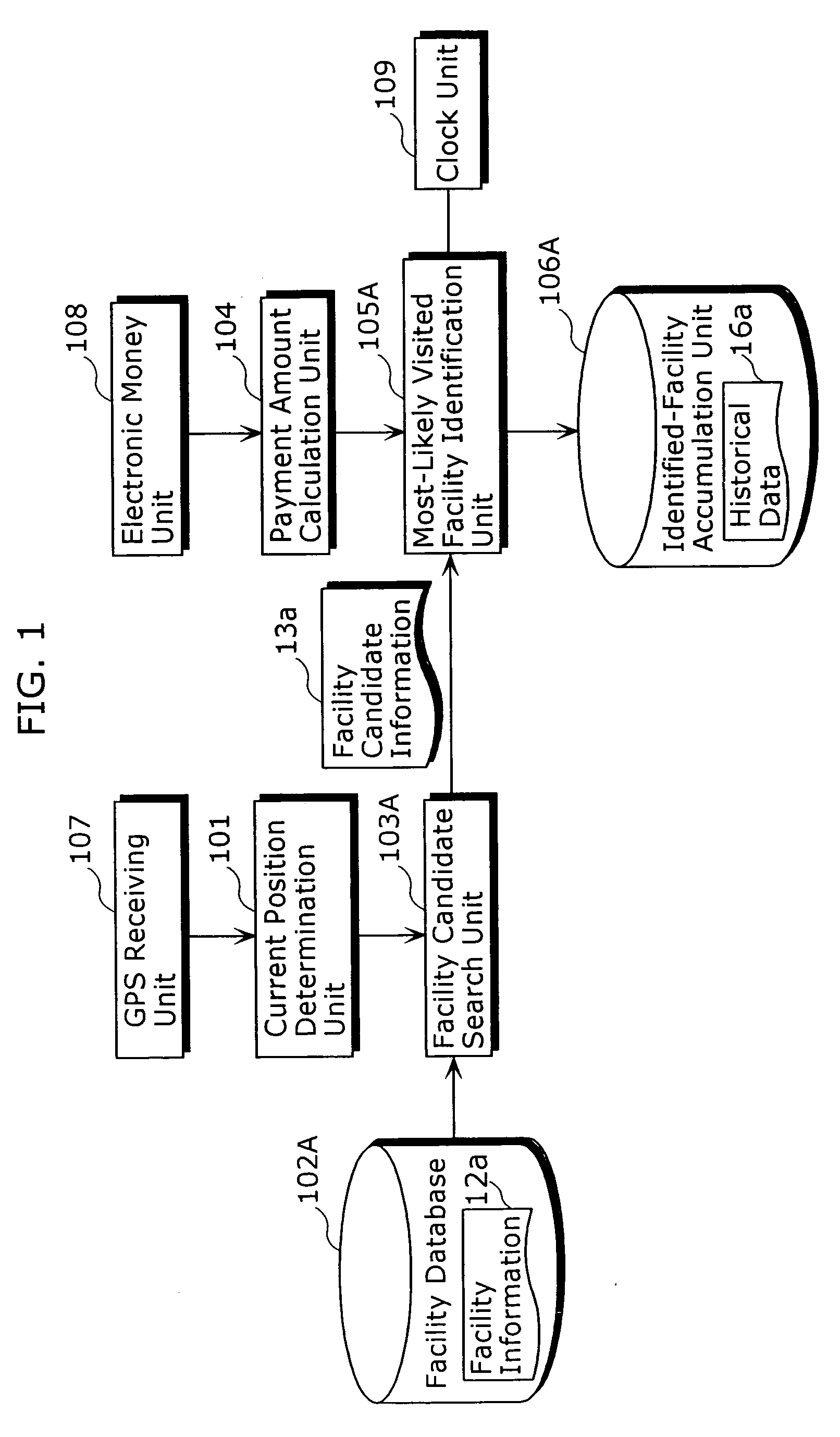

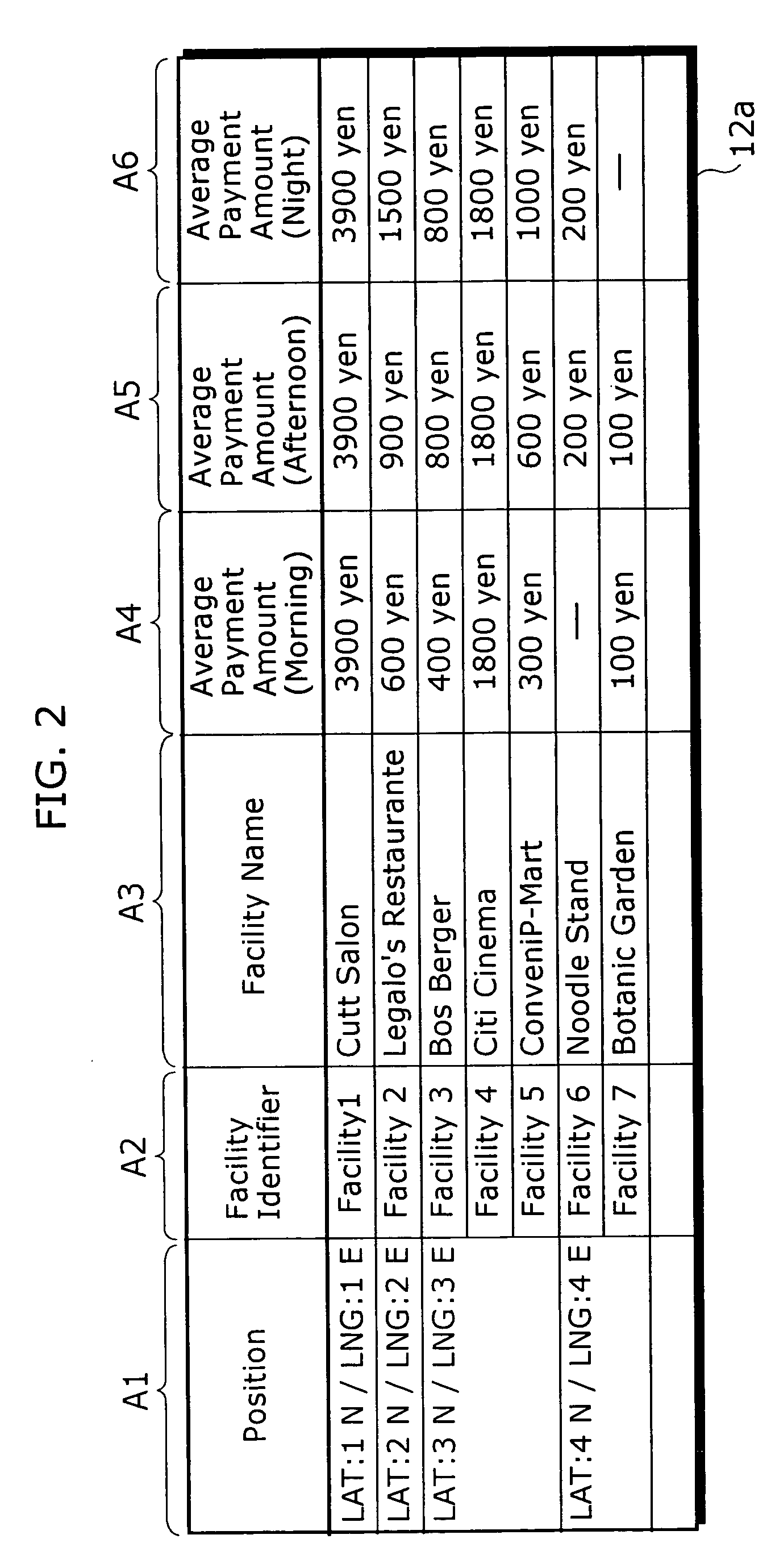

The present invention includes: a current position determination unit (101) that determines a current position of a user; a facility candidate search unit (103A) that specifies, as a candidate for a visited place, a facility that is located within a predetermined area including the current position determined by the current position determination unit (101); an electronic money unit (108) and a payment amount calculation unit (104) that detect a payment amount of the user; and a most-likely visited facility identification unit (105A) that identifies a most-likely visited place by selecting from a plurality of facilities a facility corresponding to the payment amount detected by the electronic money unit (108) and the payment amount calculation unit (104), when the plurality of facilities are specified by the facility candidate search unit (103A).

Owner:GK BRIDGE 1

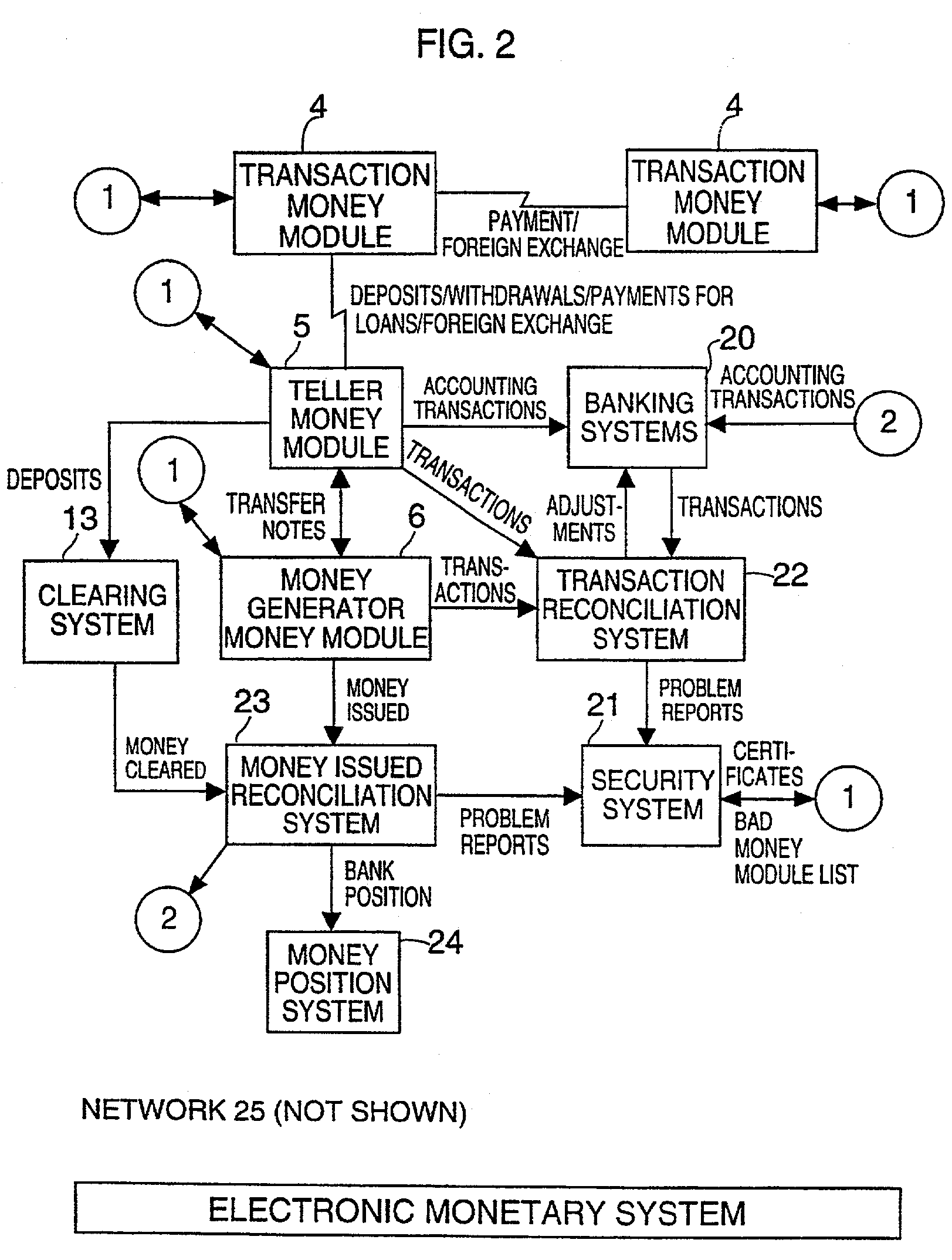

Electronic-monetary system

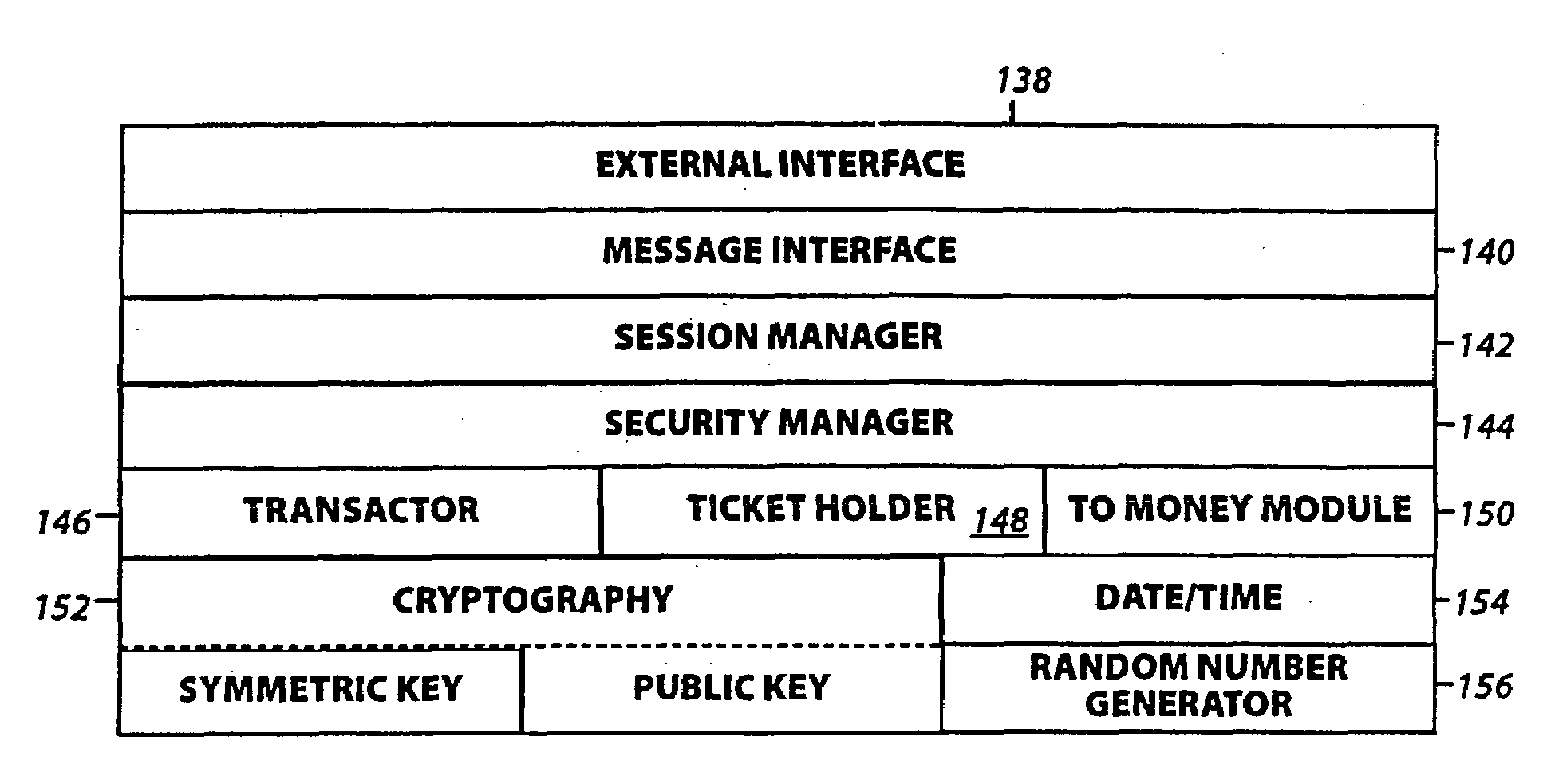

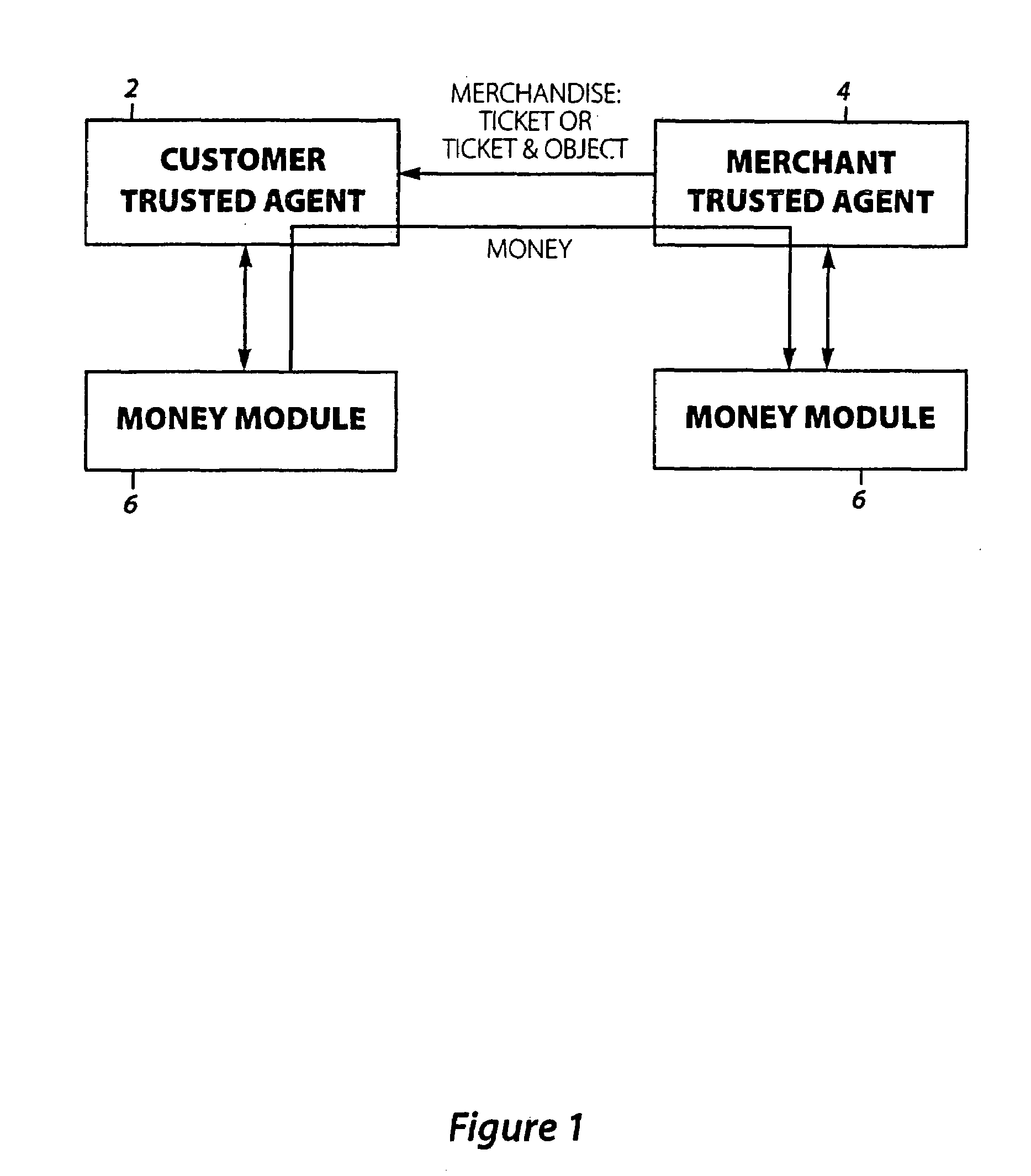

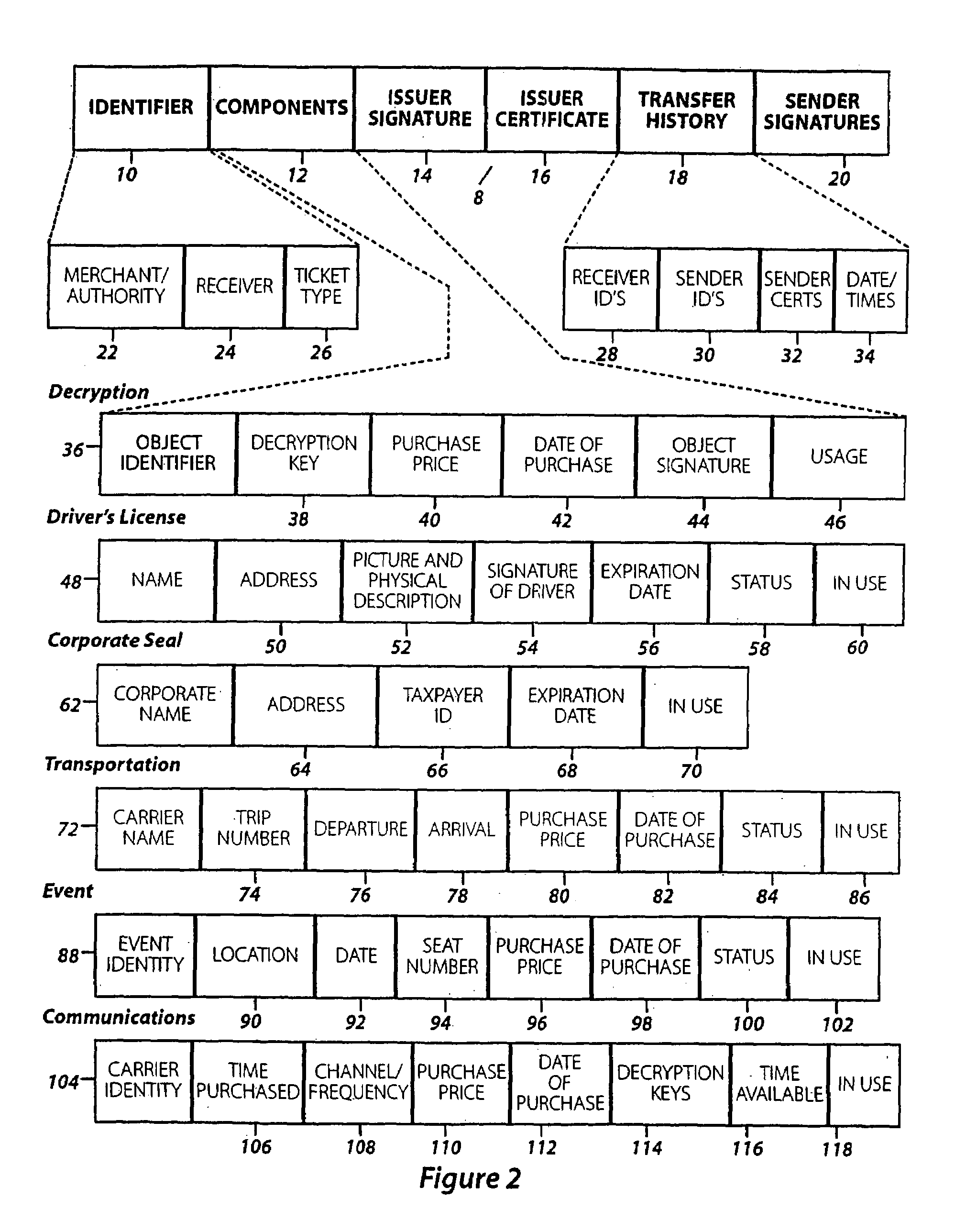

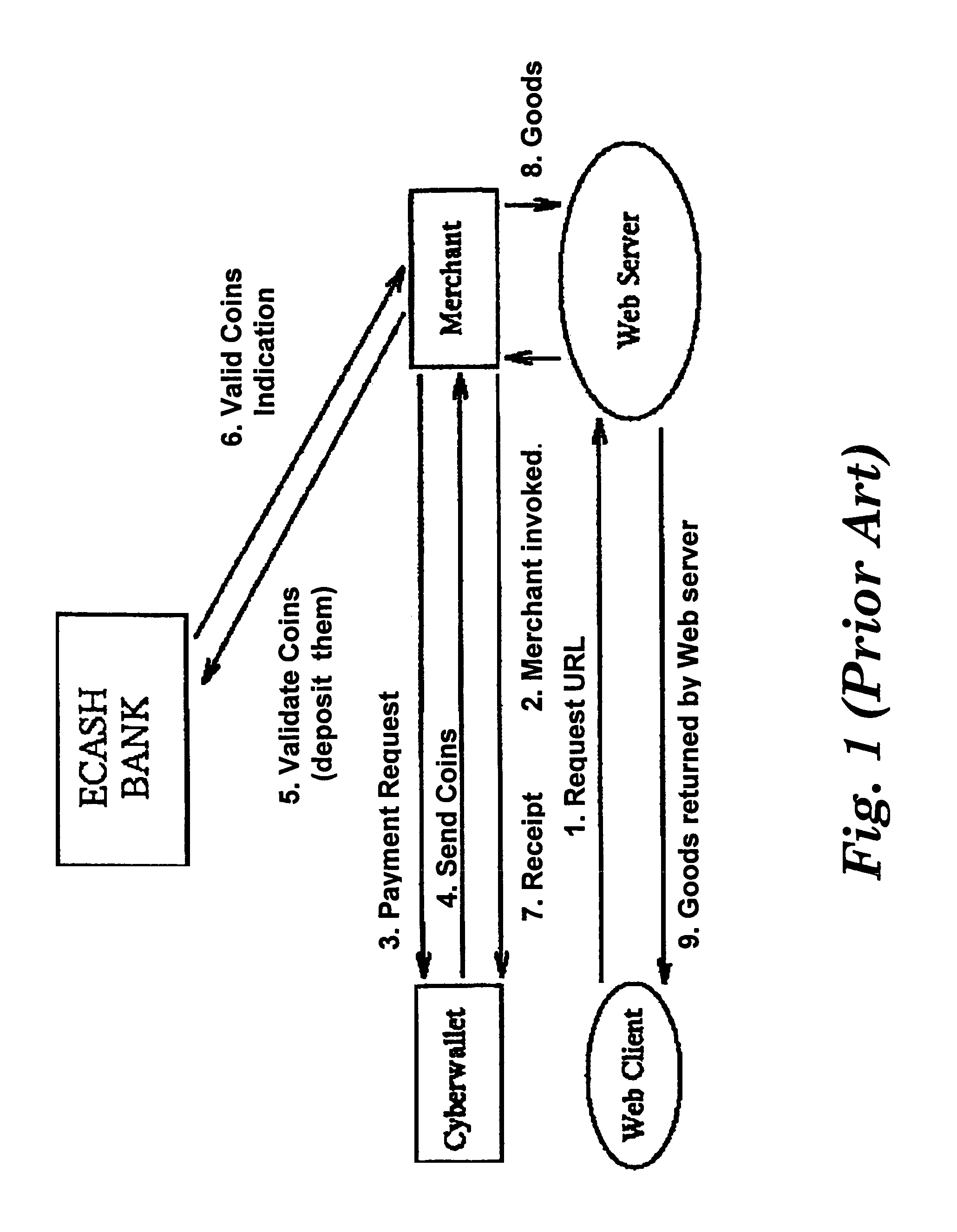

An improved monetary system using electronic media to exchange economic value securely and reliably is disclosed. The system provides a complete monetary system having electronic money that is interchangeable with conventional paper money. Also disclosed is a system for open electronic commerce having a customer trusted agent securely communicating with a first money module, and a merchant trusted agent securely communicating with a second money module. Both trusted agents are capable of establishing a first cryptographically secure session, and both money modules are capable of establishing a second cryptographically secure session. The merchant trusted agent transfers electronic merchandise to the customer trusted agent, and the first money module transfers electronic money to the second money module. The money modules inform their trusted agents of the successful completion of payment, and the customer may use the purchased electronic merchandise.

Owner:CITIBANK

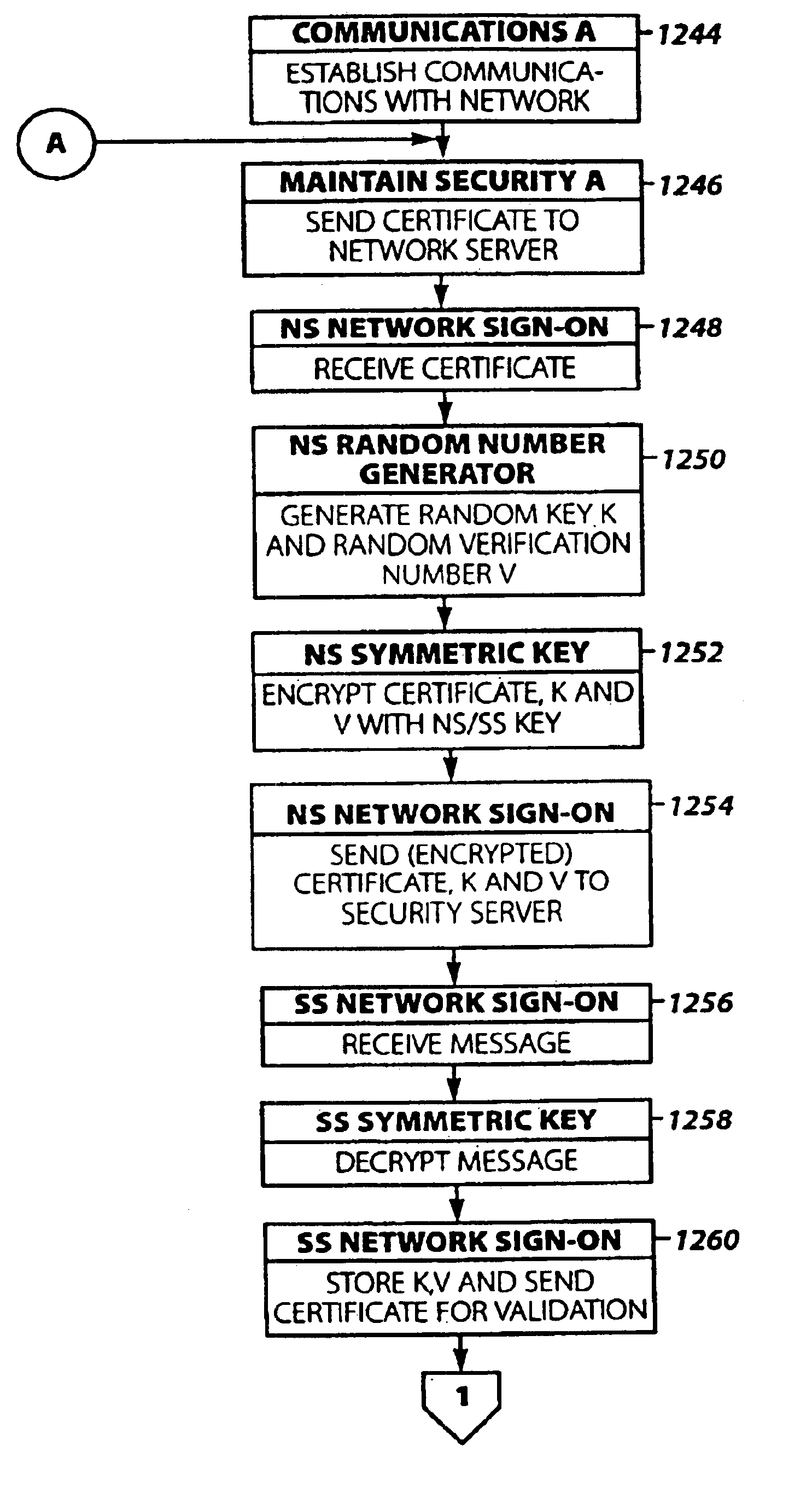

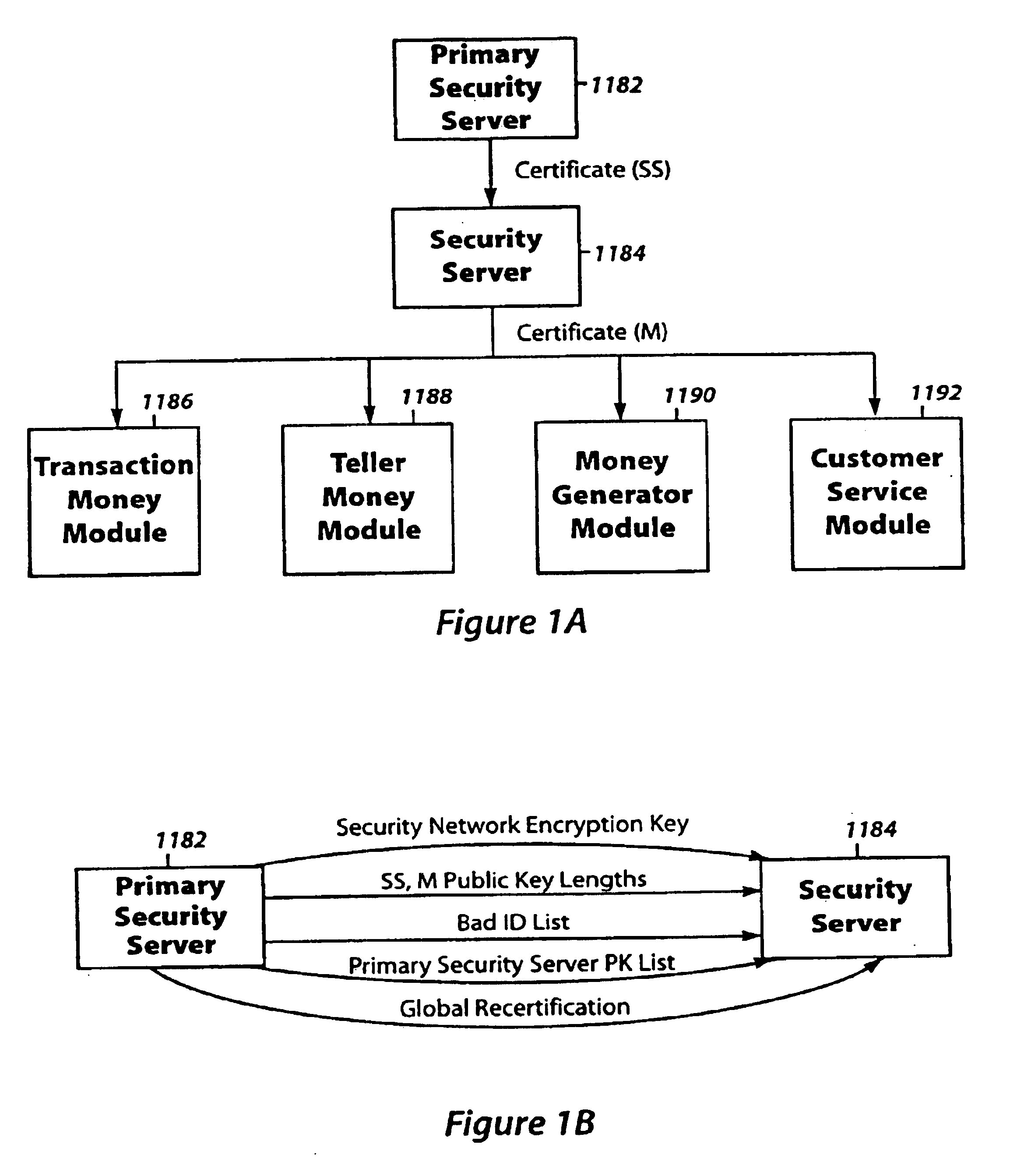

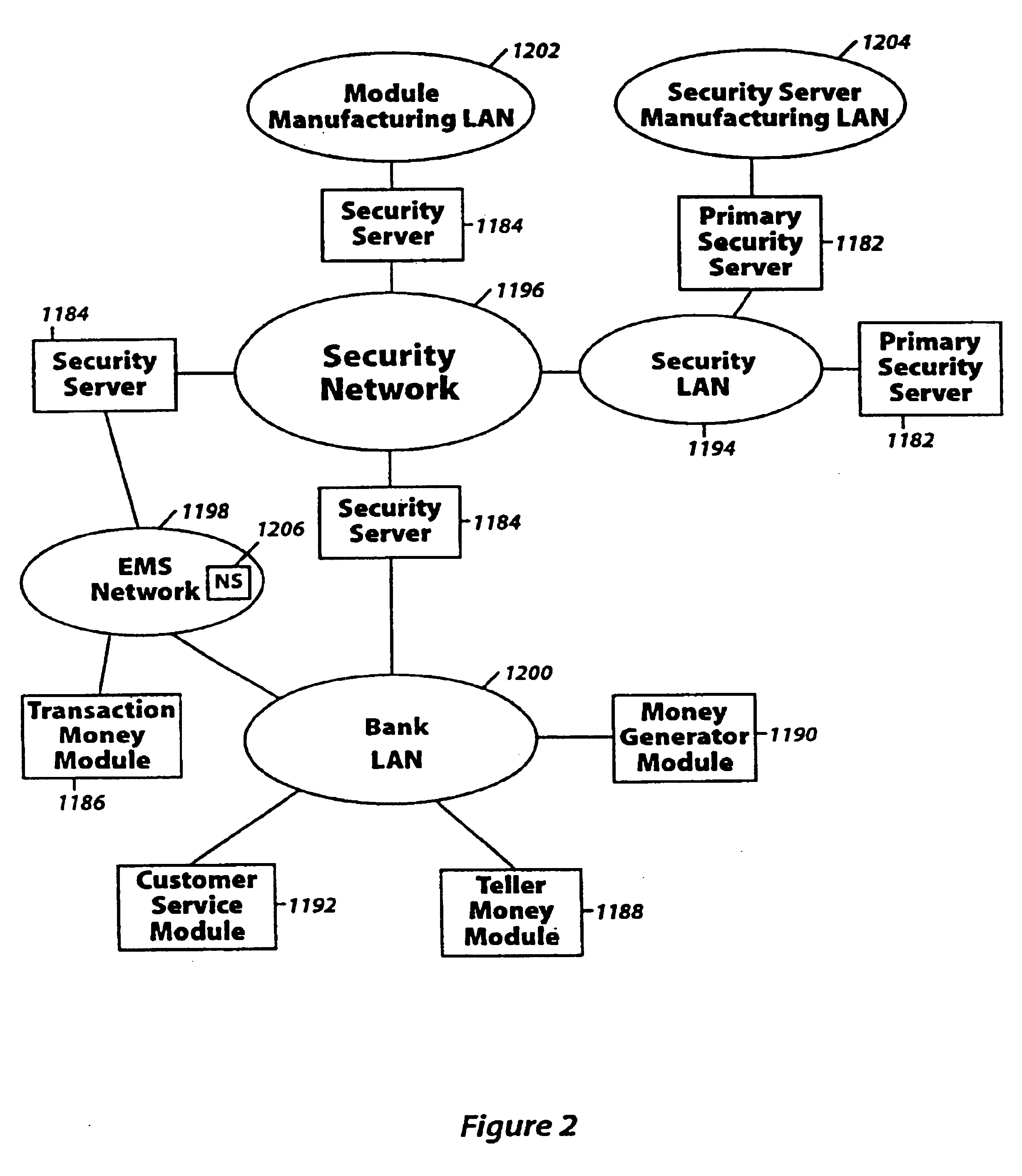

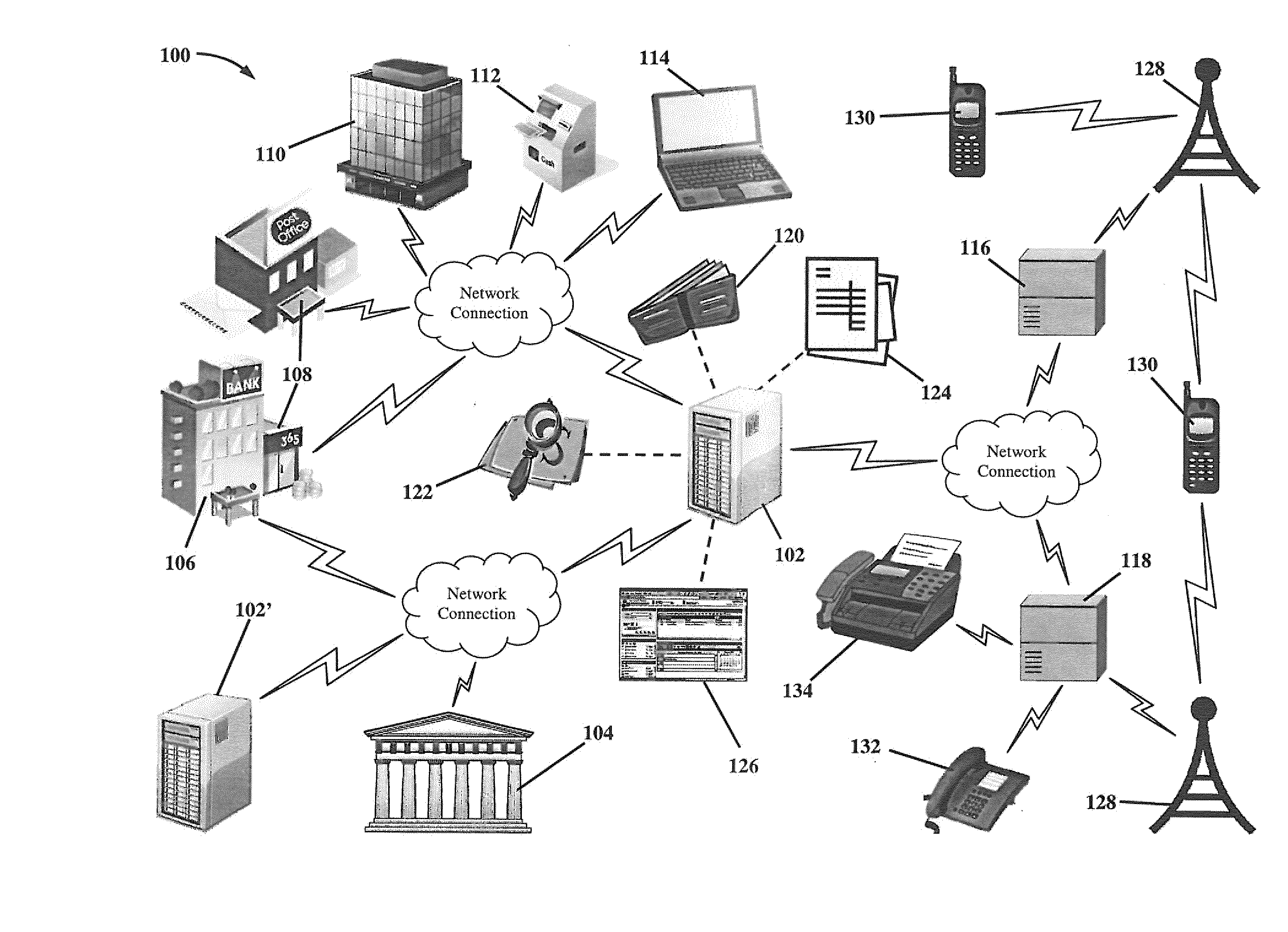

Security systems and methods applicable to an electronic monetary system

InactiveUS6868408B1Reliably purchase goodsUser identity/authority verificationComputer security arrangementsIssuing bankComputer module

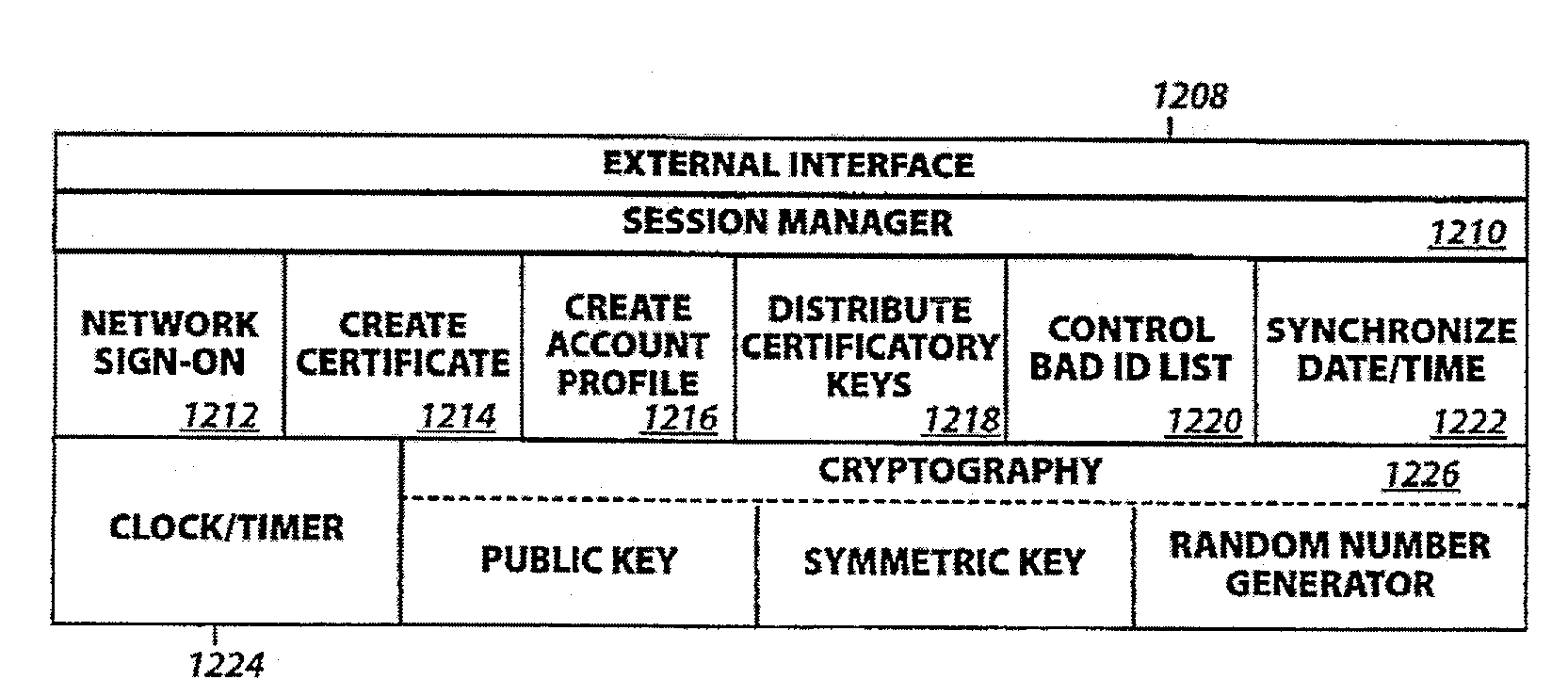

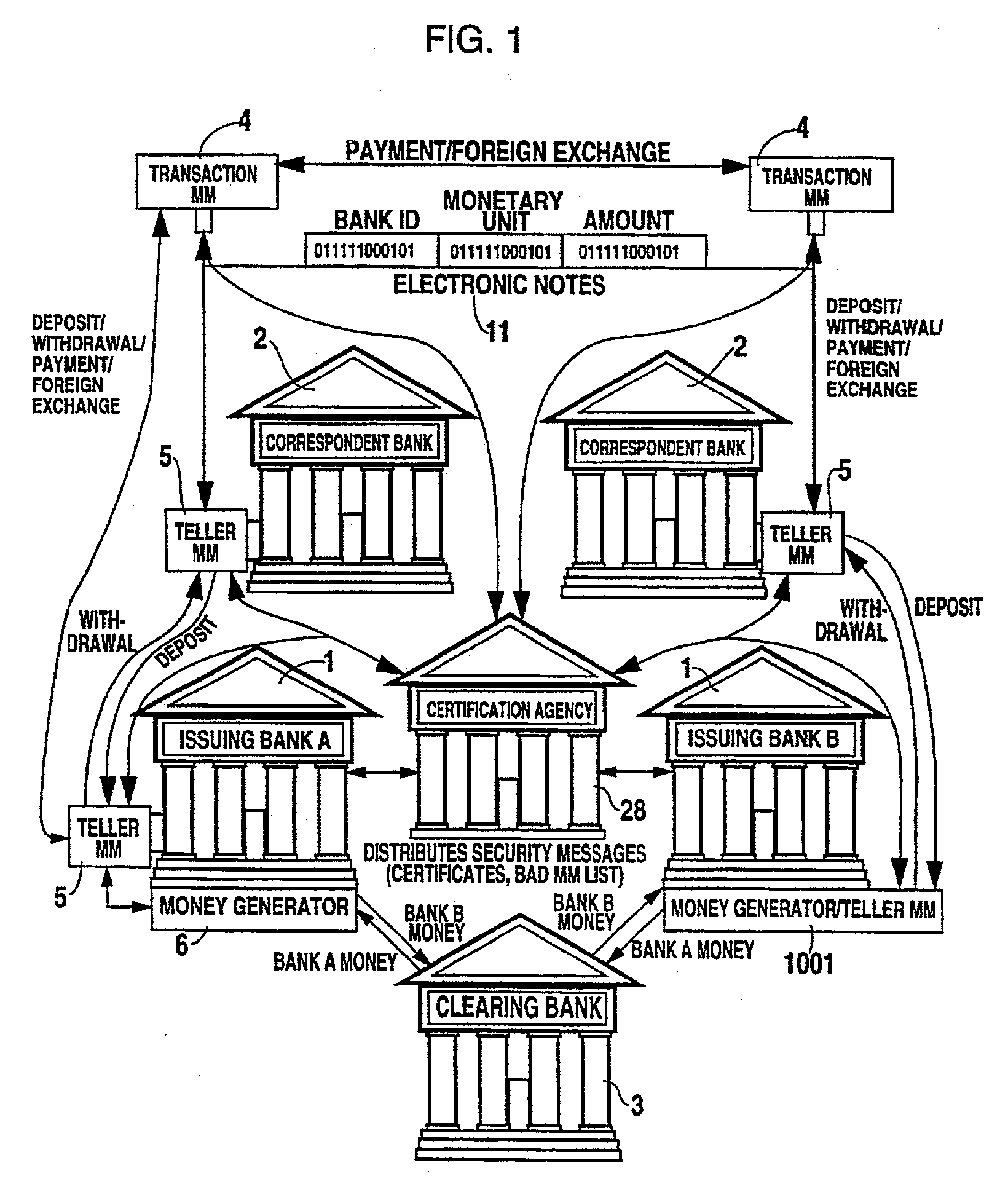

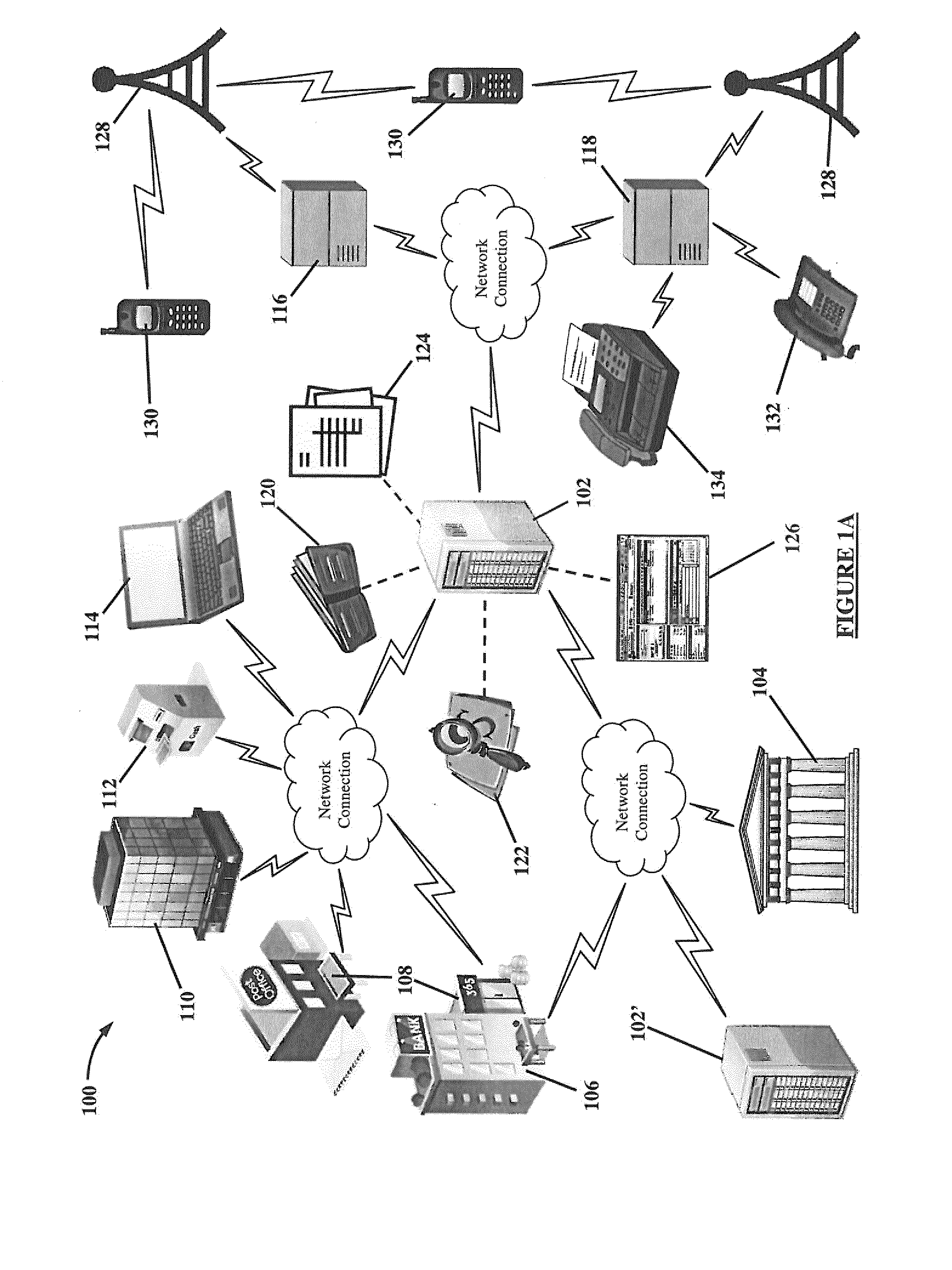

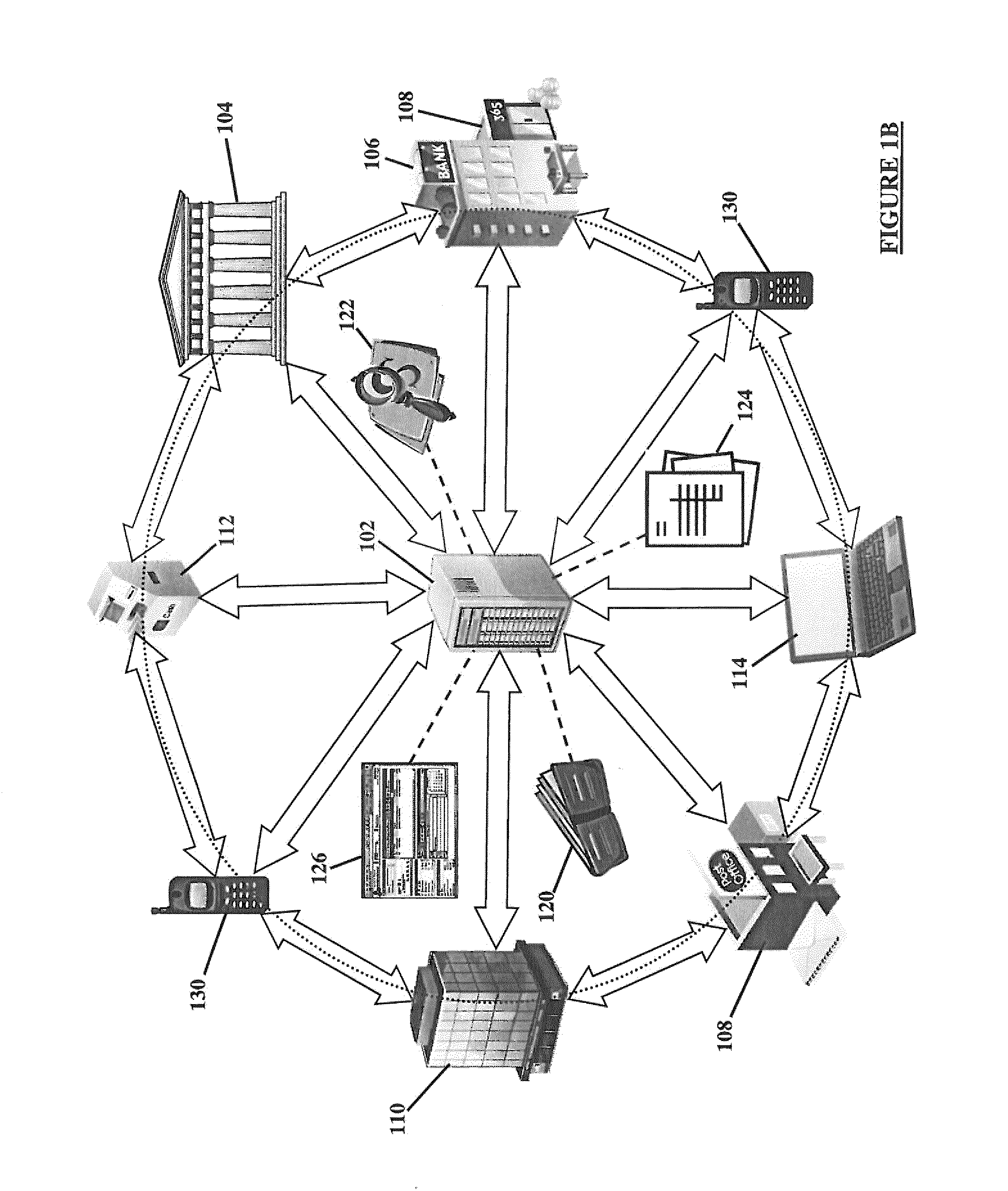

An electronic-monetary system having (1) banks or financial institutions that are coupled to a money generator device for generating and issuing to subscribing customers electronic money including electronic currency backed by demand deposits and electronic credit authorizations; (2) correspondent banks that accept and distribute the electronic money; (3) a plurality of transaction devices that are used by subscribers for storing electronic money, for performing money transactions with the on-line systems of the participating banks or for exchanging electronic money with other like transaction devices in off-line transactions; (4) teller devices, associated with the issuing and correspondent banks, for process handling and interfacing the transaction devices to the issuing and correspondent banks, and for interfacing between the issuing and correspondent banks themselves; (5) a clearing bank for balancing the electronic money accounts of the different issuing banks; (6) a data communications network for providing communications services to all components of the system; and (7) a security arrangement for maintaining the integrity of the system, and for detecting counterfeiting and tampering within the system. This system includes a customer service module which handles lost money claims and links accounts to money modules for providing bank access.

Owner:CITIBANK

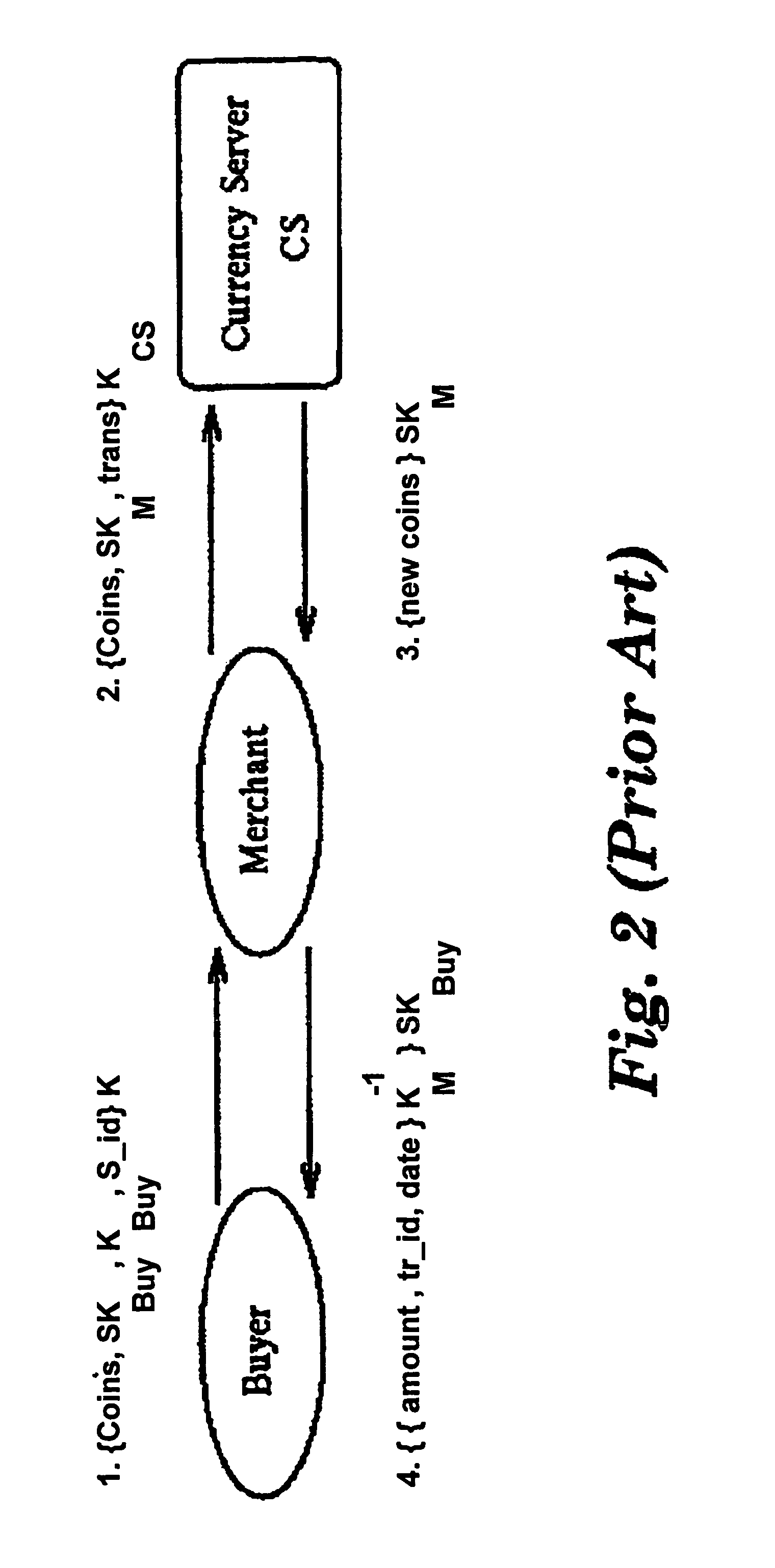

Electronic transaction apparatus for electronic commerce

A system for open electronic commerce having a customer trusted agent securely communicating with a first money module, and a merchant trusted agent securely communicating with a second money module. Both trusted agents are capable of establishing a first cryptographically secure session, and both money modules are capable of establishing a second cryptographically secure session. The merchant trusted agent transfers electronic merchandise to the customer trusted agent, and the first money module transfers electronic money to the second money module. The money modules inform their trusted agents of the successful completion of payment, and the customer may use the purchased electronic merchandise.

Owner:CITIBANK

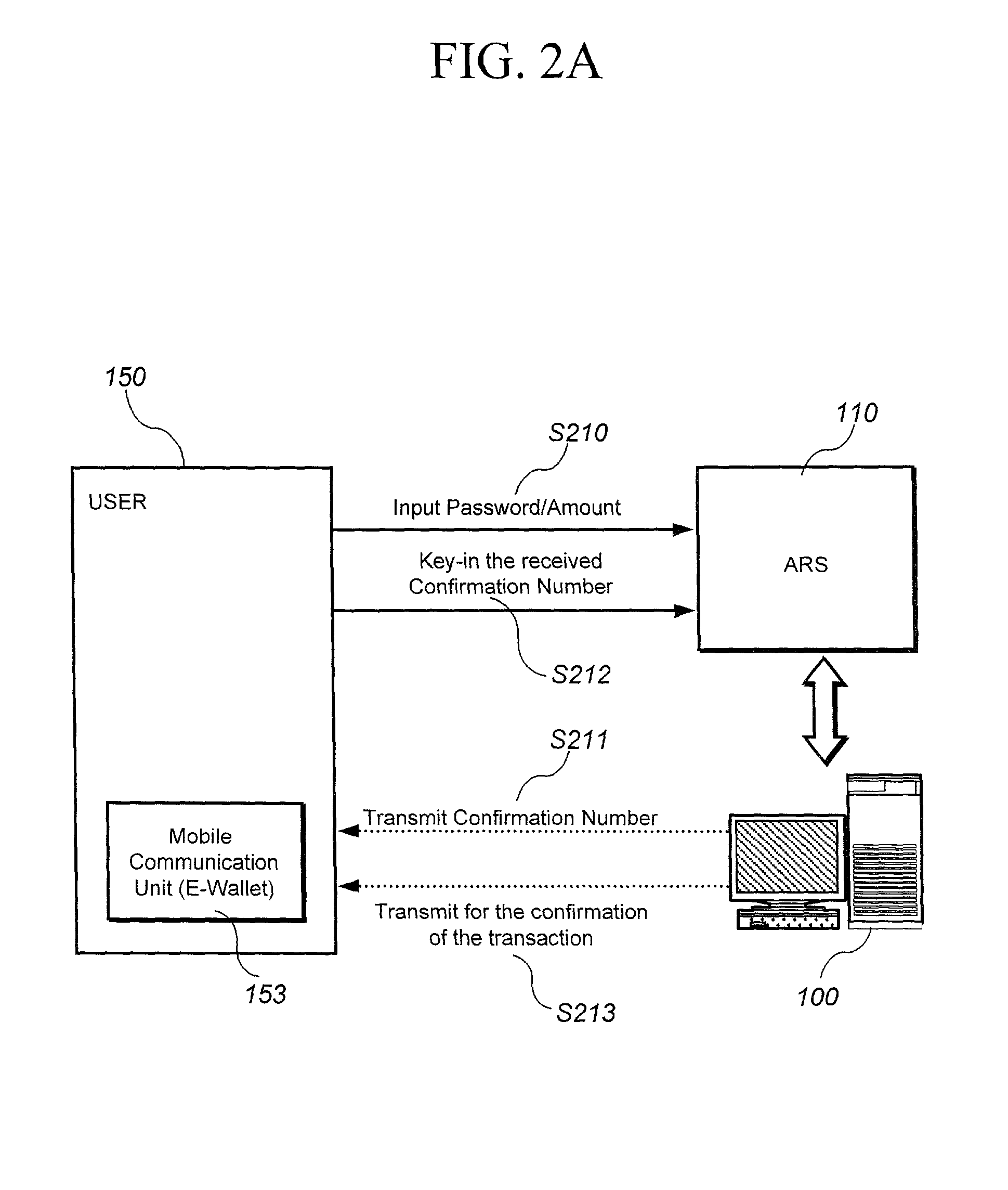

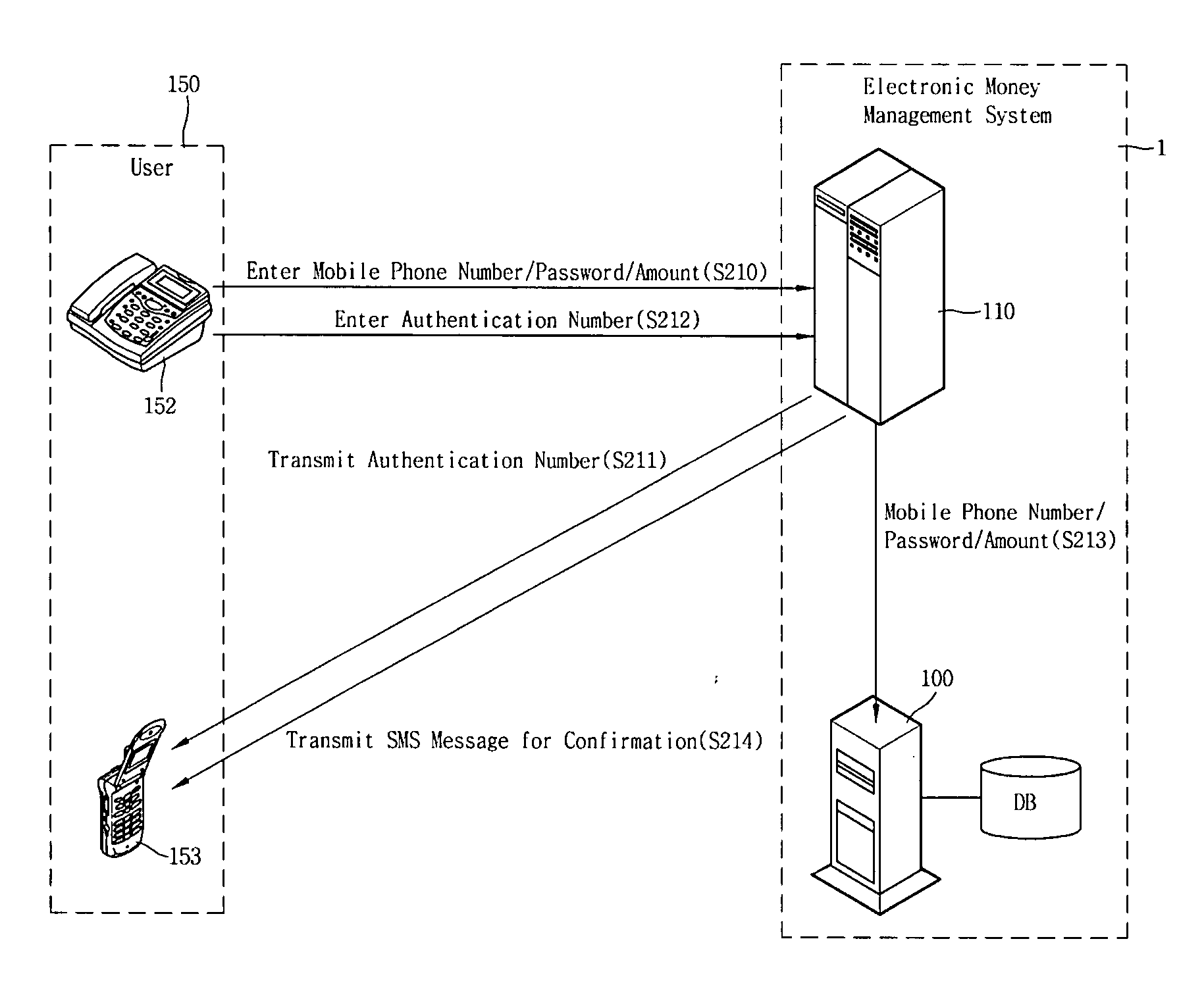

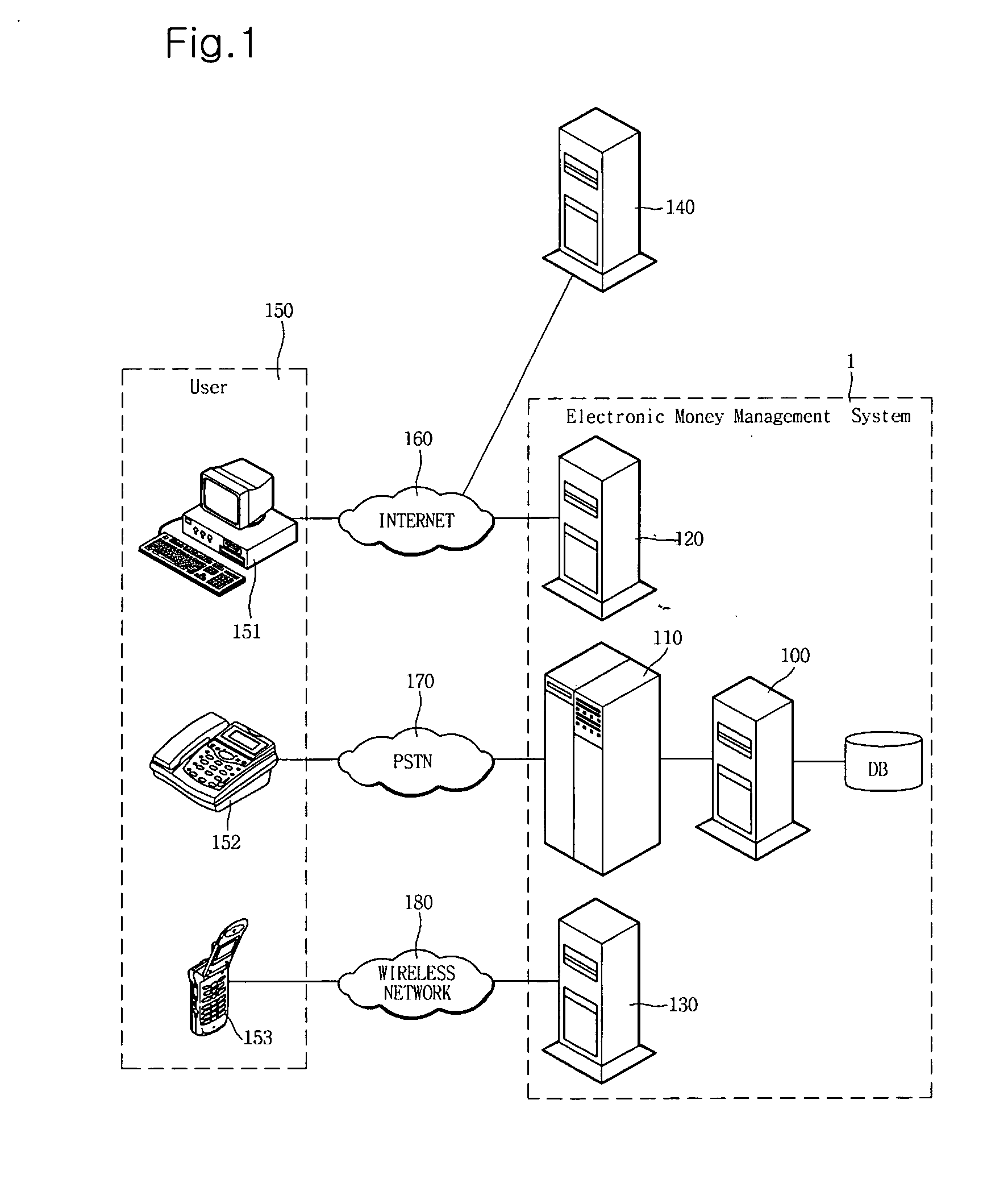

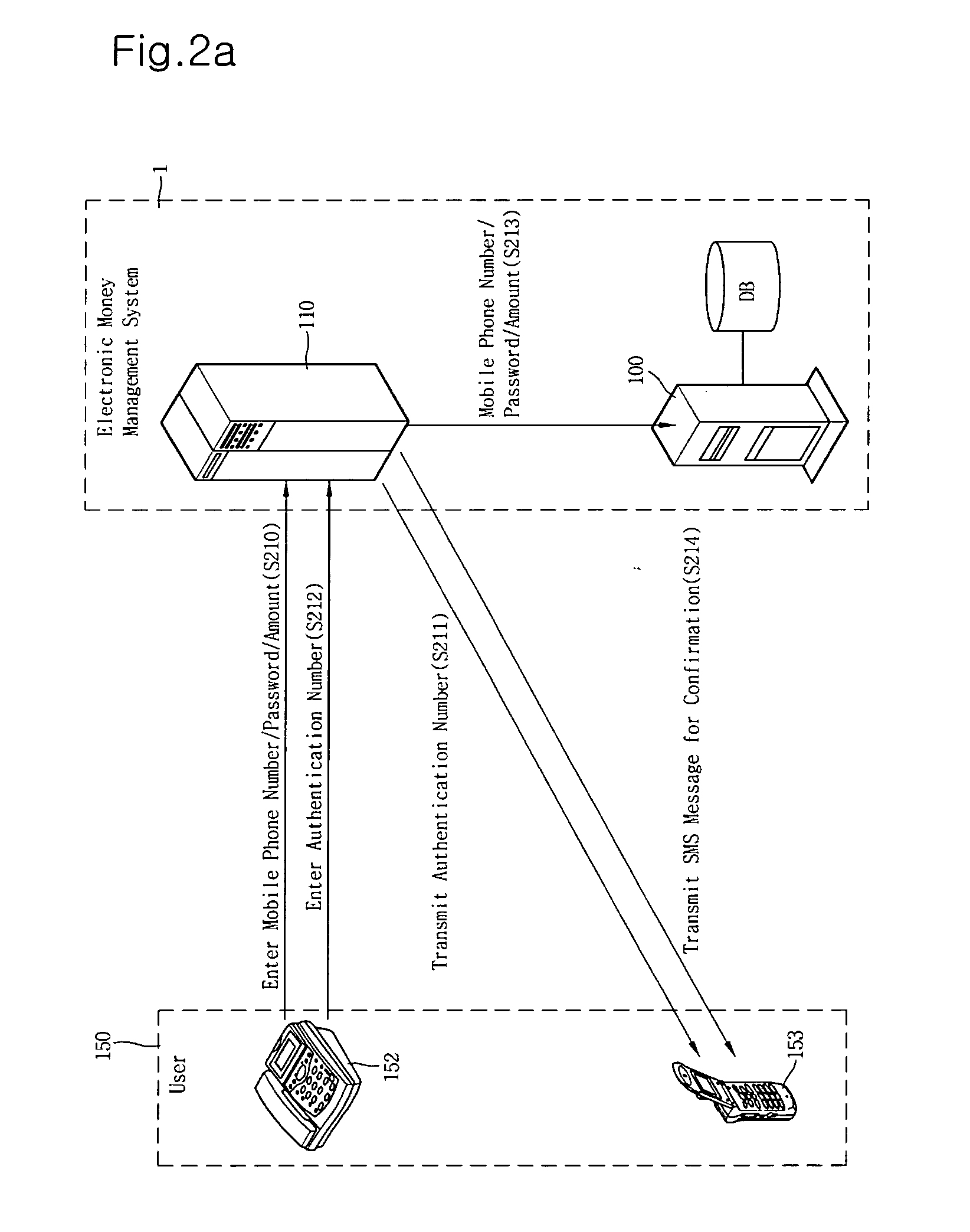

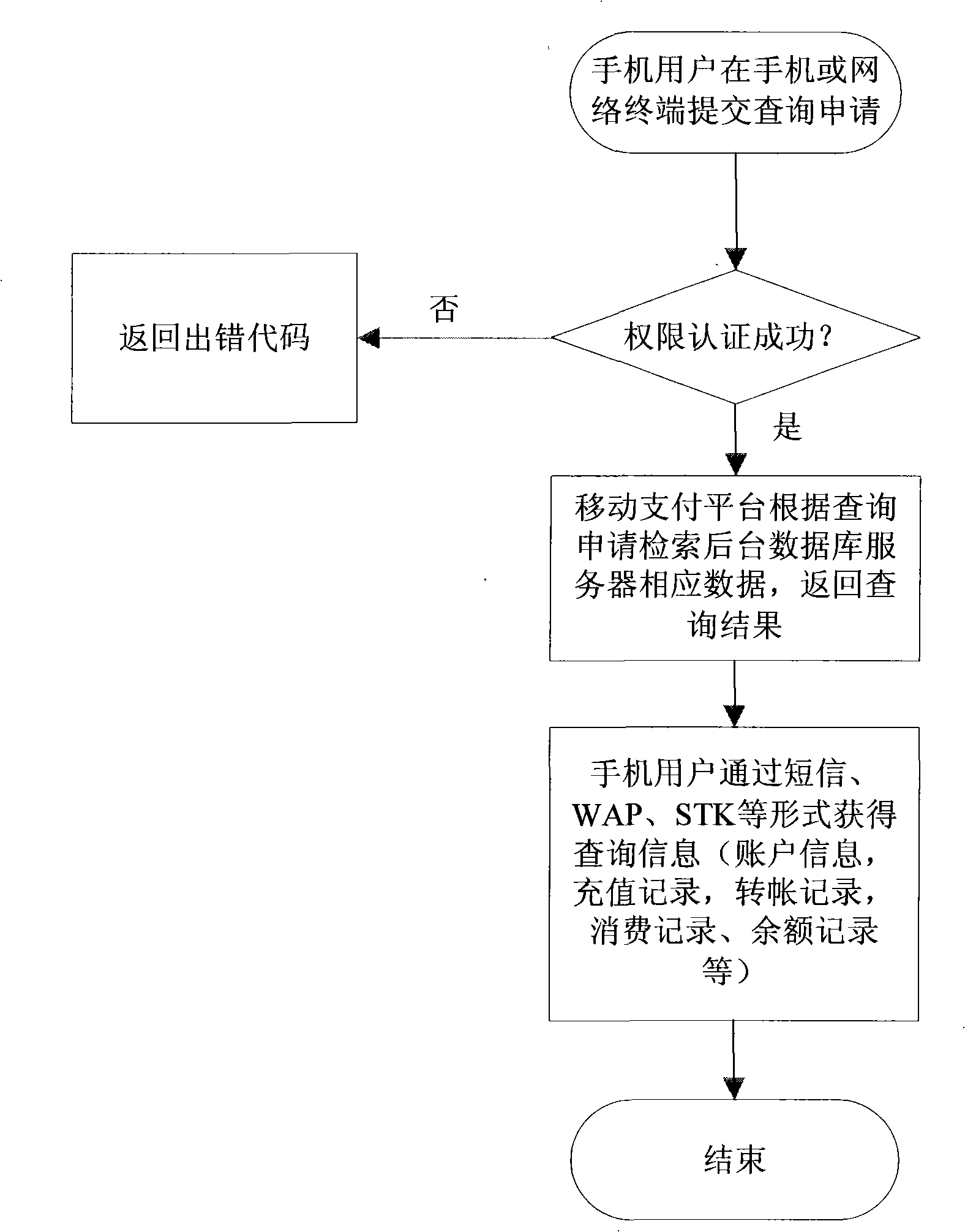

Electronic money management method and system using mobile communication terminal

An electronic money management method and system using a mobile phone is provided, which can be applied to electronic transactions. Upon receiving a request regarding electric money such as issuance, recharging, transfer, or balance checking, together with a mobile phone number and a password, from a user, an ARS server, an electronic money management web server, or an mobile communication service system transmits an authentication number to the user's mobile phone, compares the transmitted authentication number with one received from the user, and transmits the password and phone number to make the request if the authentication numbers are identical. The electronic money management server fulfills the request regarding electronic money, received from the one server or system, for an electronic money account identified by the password and mobile phone number, and transmits the fulfilled result and the account balance to the mobile phone through the one server or system.

Owner:INFOHUB

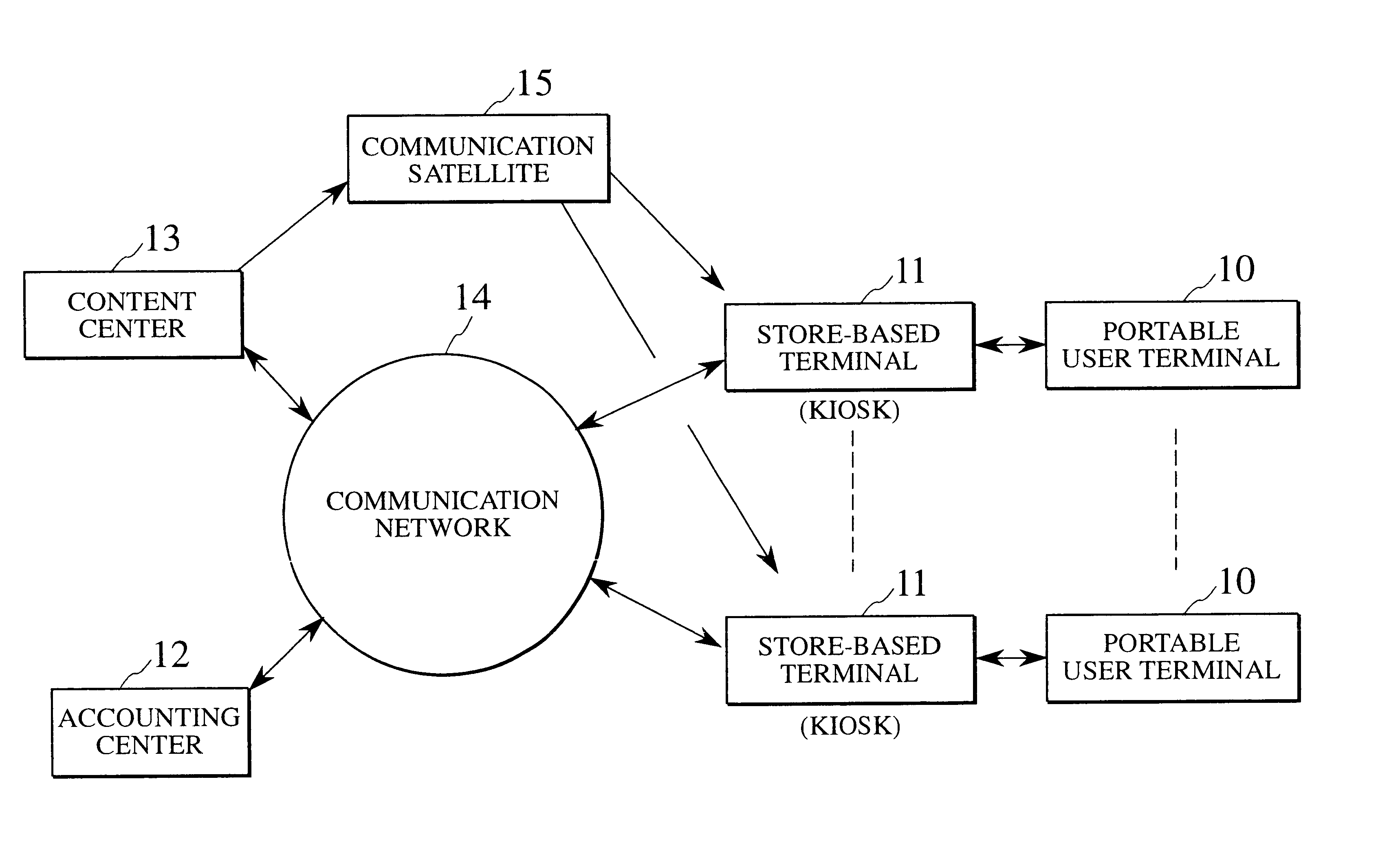

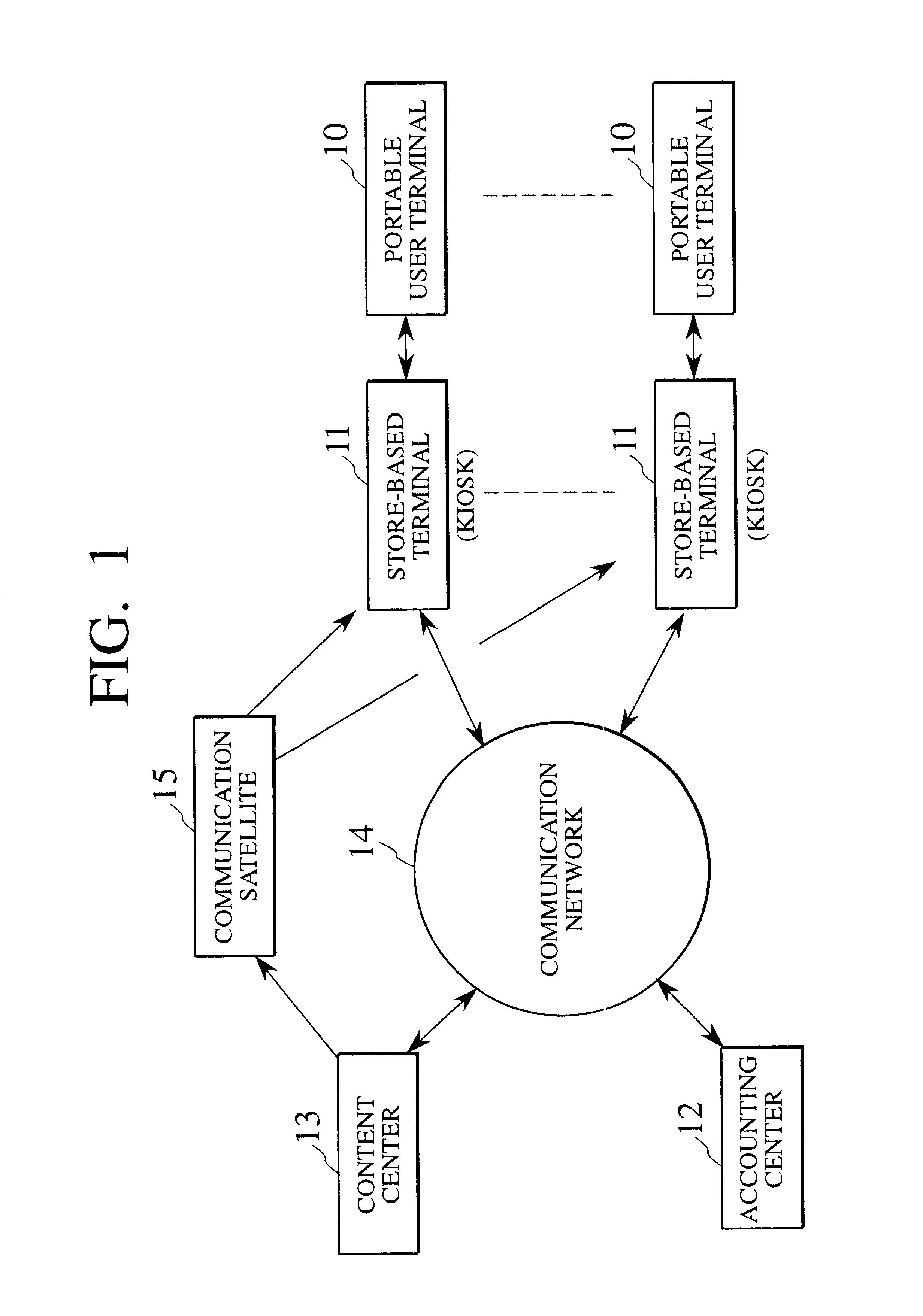

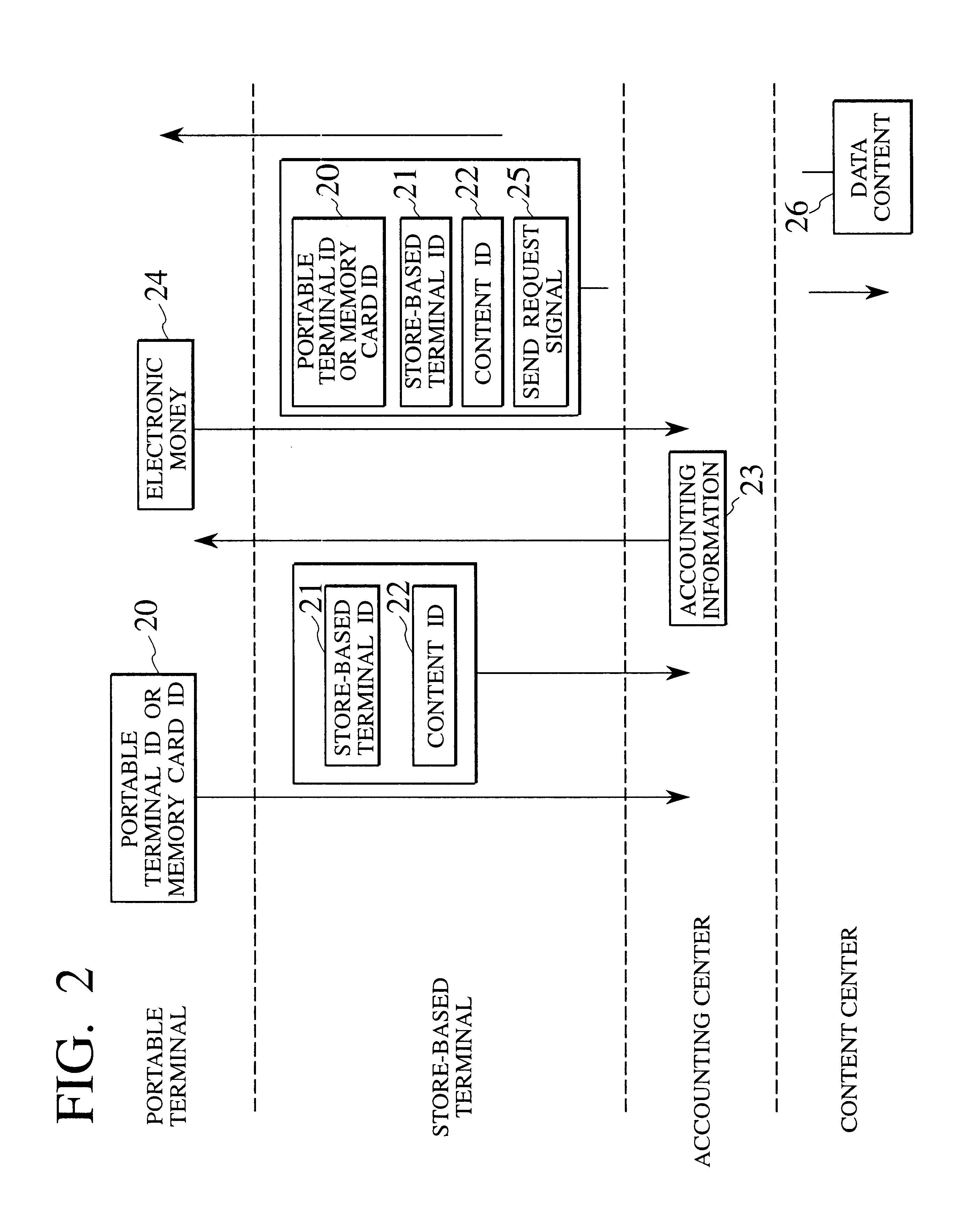

Data distribution system, data distribution method, portable terminal with data receiving capability, portable terminal with data transmitting/receiving capability, recording medium onto which data content is recorded, encoding apparatus, and decoding apparatus

InactiveUS7113927B1Low costInhibitory contentComputer security arrangementsBuying/selling/leasing transactionsDistribution methodDistribution system

A data distribution system has a portable user terminal, which sends a portable terminal ID or memory card ID and electronic money are sent to a store-based terminal (10) and receives data content, a store-based terminal (11), which receives the portable terminal ID or memory card ID and electronic money from the portable user terminal (10), and which sends these to a billing center (12), along with a content ID and a store-based terminal ID, a billing center (12) that receives the content ID, the portable terminal ID or memory card ID, the store-based terminal ID, and the electronic money from the store-based terminal (11), and a content center (13), which receives the content ID, the portable terminal ID or memory card ID, and the store-based terminal ID, and which distributes data content, via the store-based terminal (11), to the portable terminal (10).

Owner:RAKUTEN INC

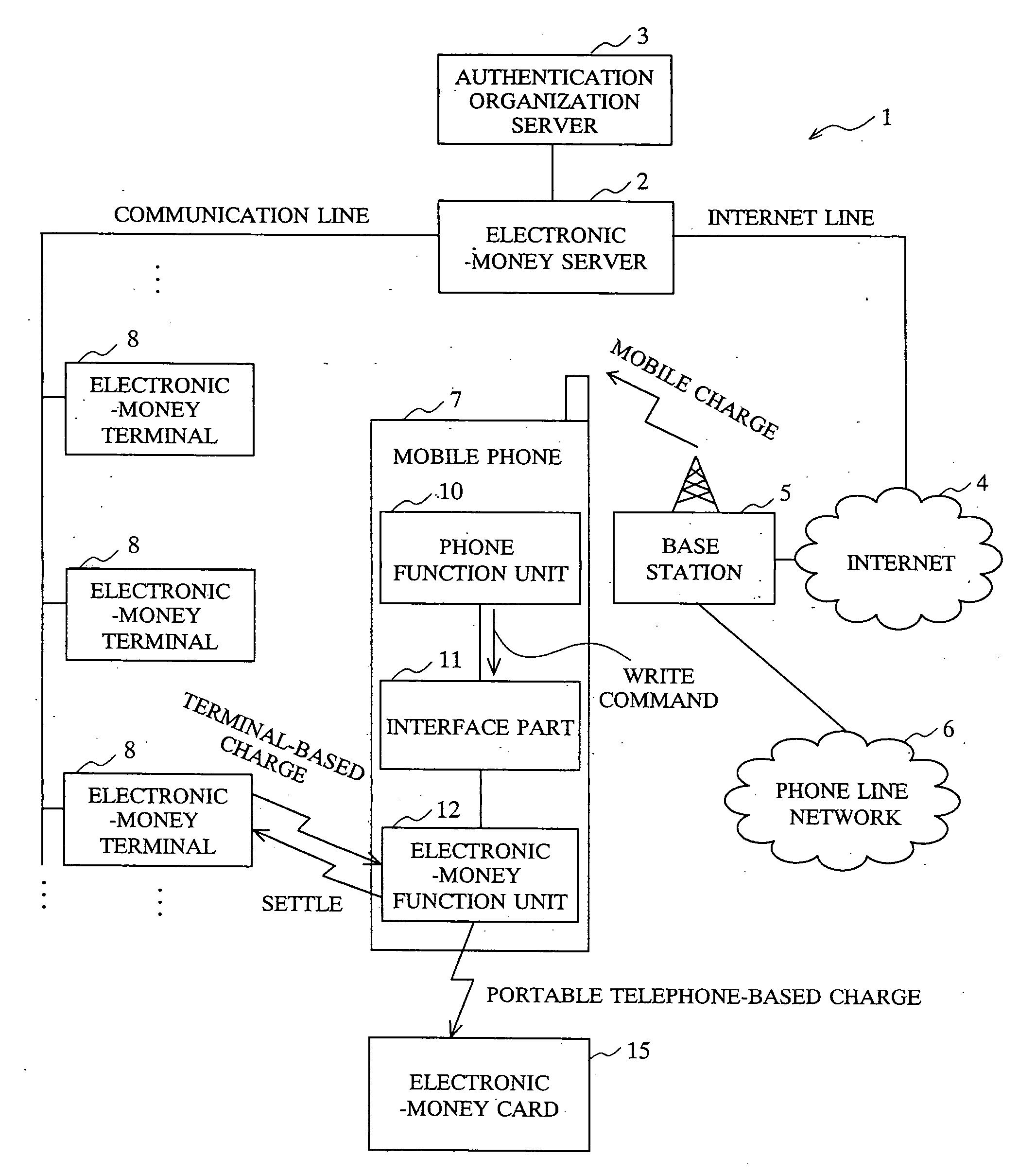

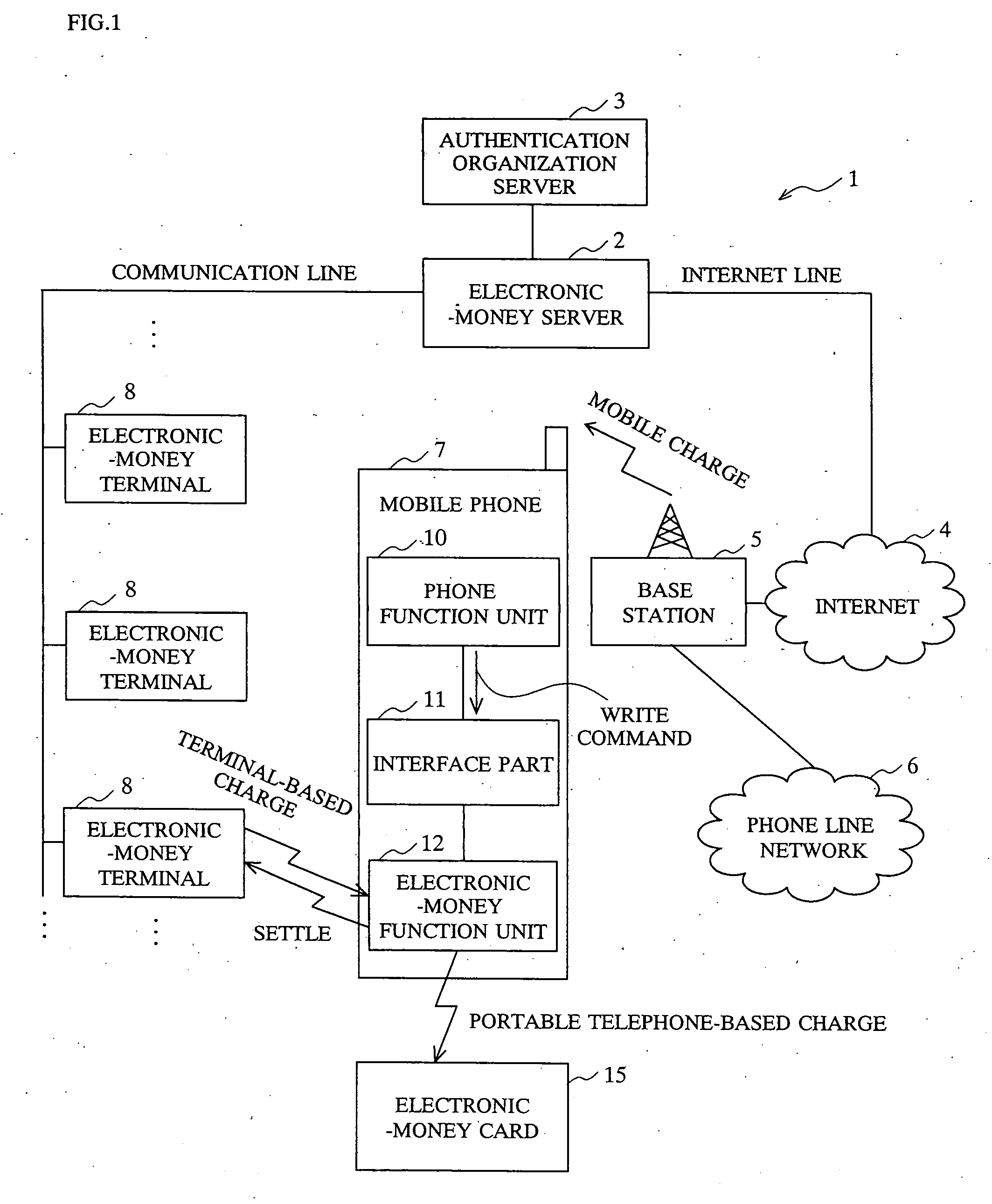

Portable terminal device, portable terminal oriented method, portable terminal oriented program, currency information issuance server apparatus, currency information issuance method, and currency information issuance program

ActiveUS20060258337A1Occasionally causing burdens to the usersEasy to carryAccounting/billing servicesFinanceVoice communicationTerminal equipment

A portable telephone (7) comprises a telephone function part (10) having a voice communications function and an Internet connecting function, and an electronic money function part (12) configured to conduct VALUE storage and VALUE handling. The telephone function part (10) is capable of accessing to a service site of an electronic money server (2) via Internet (4). Request by a user from the telephone function part (10) to the service site of the electronic money server (2) for VALUE entering, causes the electronic money server (2) to transmit an entering command to the portable telephone (7) for causing the electronic money function part (12) to execute VALUE entering. The electronic money function part (12) inputs the entering command in the electronic money function part (12) thereby causing the electronic money function part (12) to conduct an entering procedure.

Owner:SONY CORP

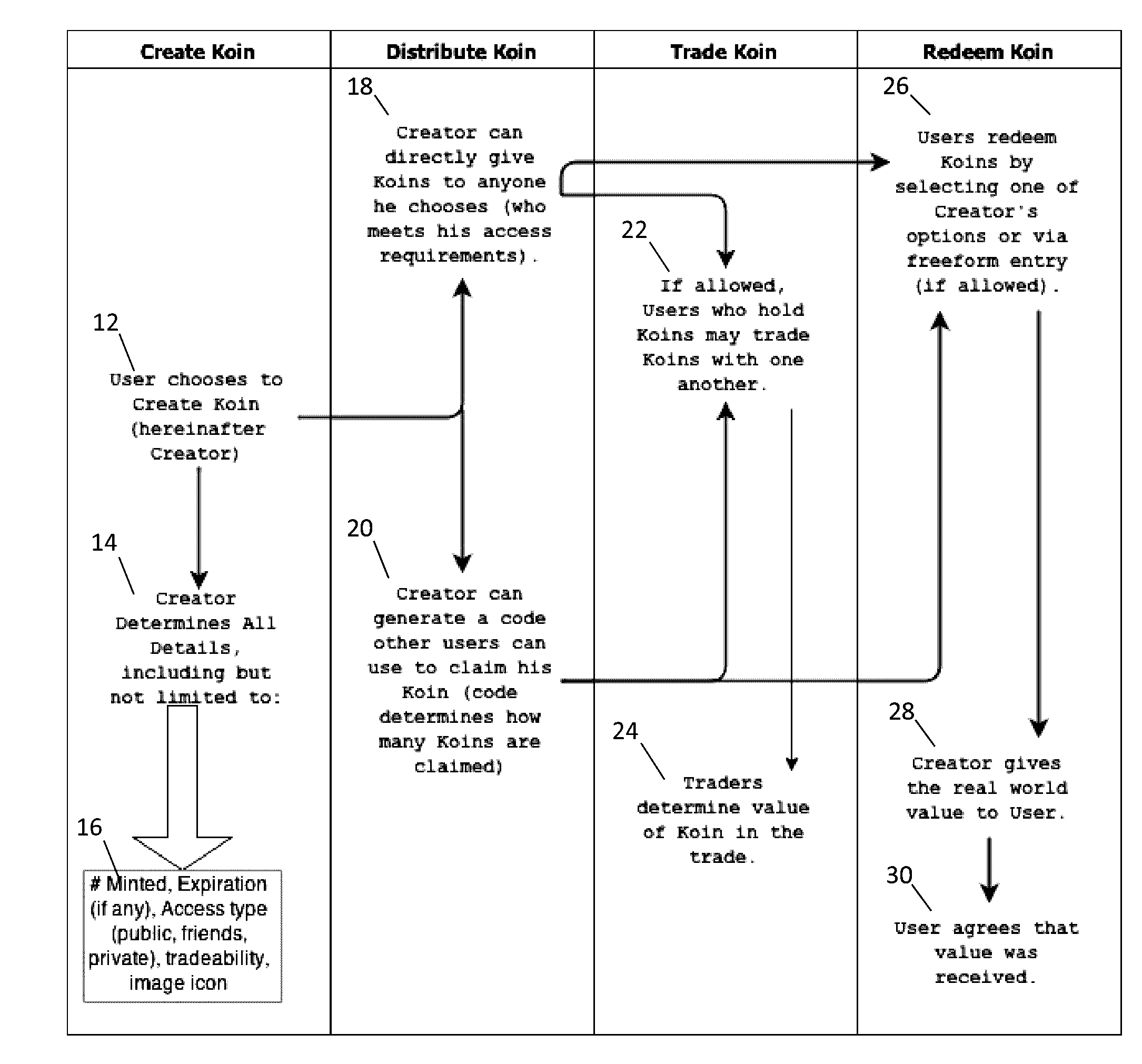

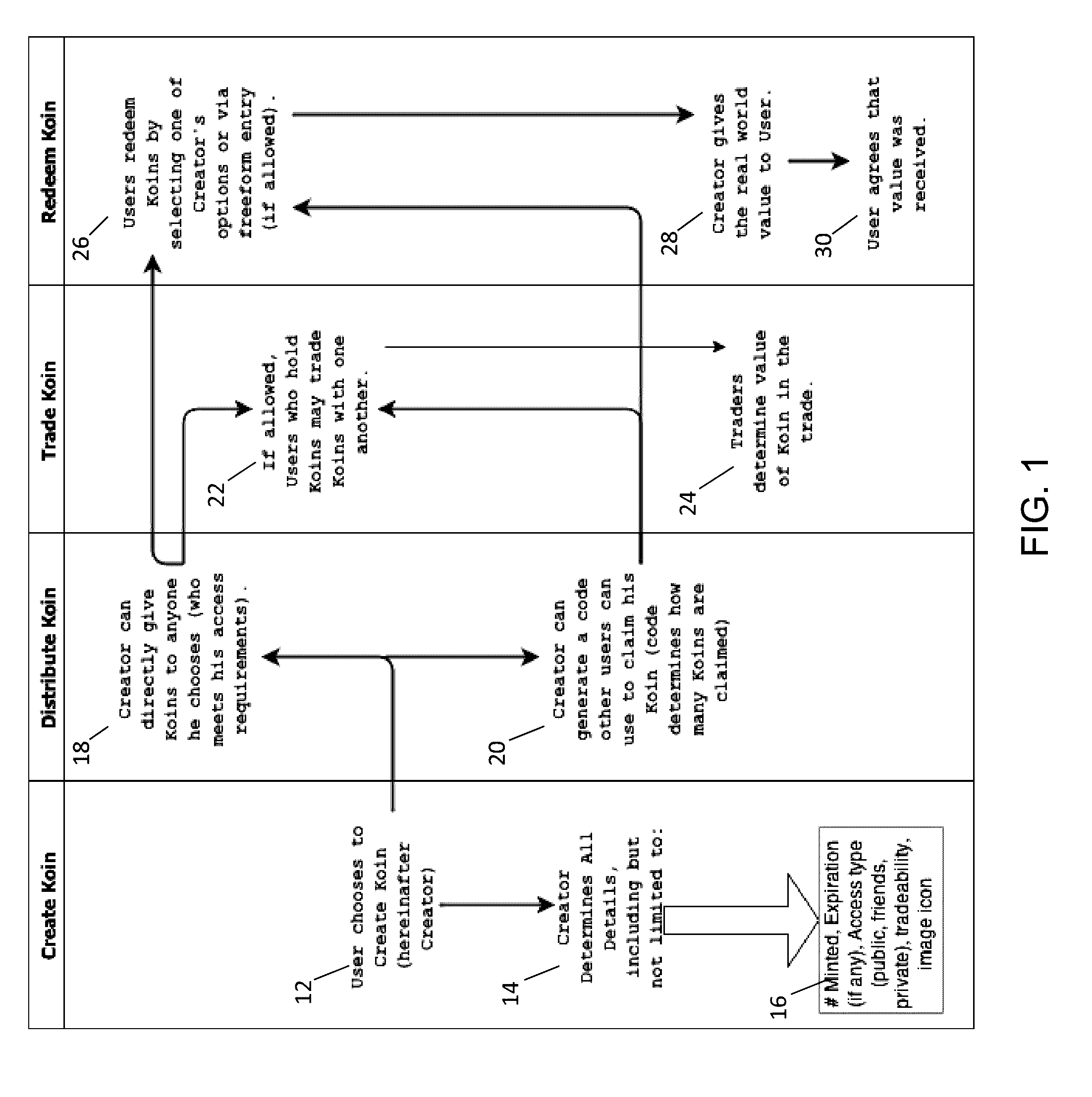

Personal electronic currency

A system and method is provided to create and use a virtual personal electronic currency. The system provides a platform and graphical user interface (GUI) that allows a user to create their own personal version(s) of digital currency that is referred to hereinafter as a “koin”, to hold, share, or trade with others. The koin is backed by the fiat of the creator, and is not traded on an open market, but rather between friends, families, groups, and organizations seeking a way to denote accomplishments or the exchange of goods and services. Embodiments of bits of koin (koinage) virtual personal electronic currency also allow people to experience direct control over their social media experience through the dissemination of their koins.

Owner:CONJECTURAL TECH LLC

System and method for providing and transferring fungible electronic money

A system and method for transferring fungible electronic money is disclosed. The system and method include two or more Central Banks that guarantee the electronic money within an electronic communications network, the electronic money being an authenticated and fungible currency capable of electronic transfer. The system and method further include registering a first user within the electronic services network, registering a second user within the electronic services network, receiving a request from the first user to transfer at least a portion of the electronic money to the second user, and electronically transferring the at least a portion of the electronic money to a mobile device belonging to the second user in response to the request received from the first user, wherein the electronic transfer occurs within the electronic communications network.

Owner:GIORI ROBERTO

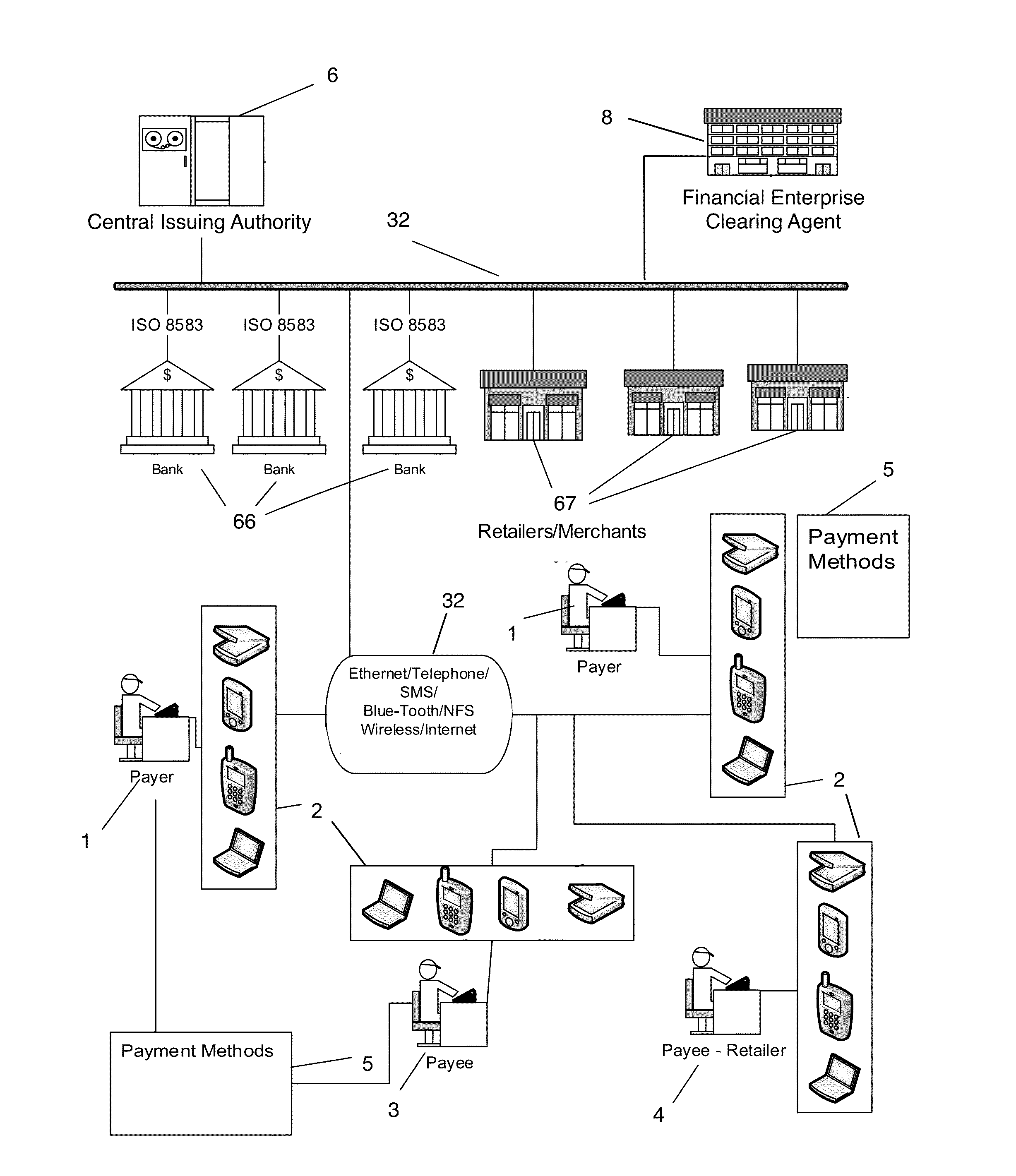

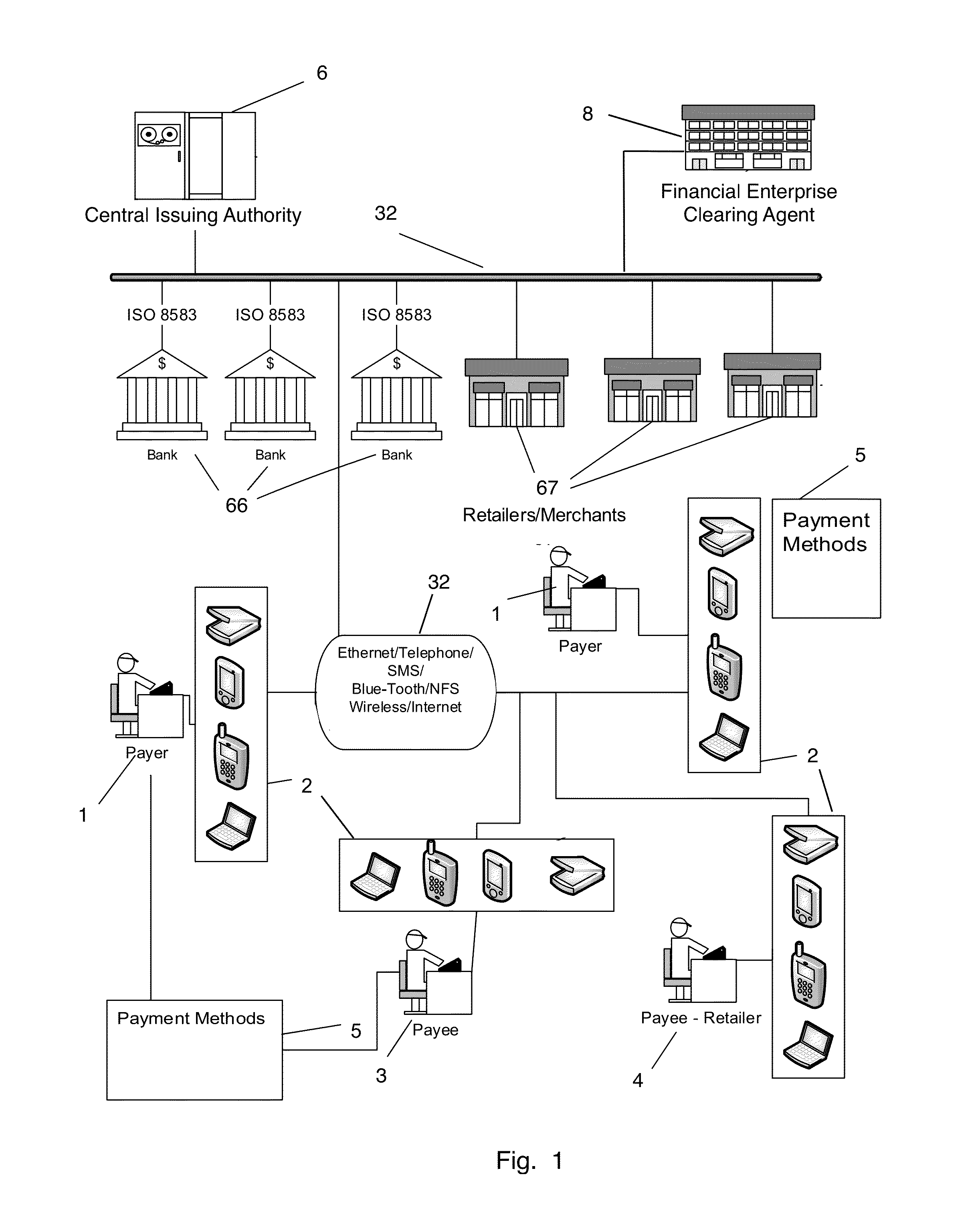

Electronic currency, electronic wallet therefor and electronic payment systems employing them

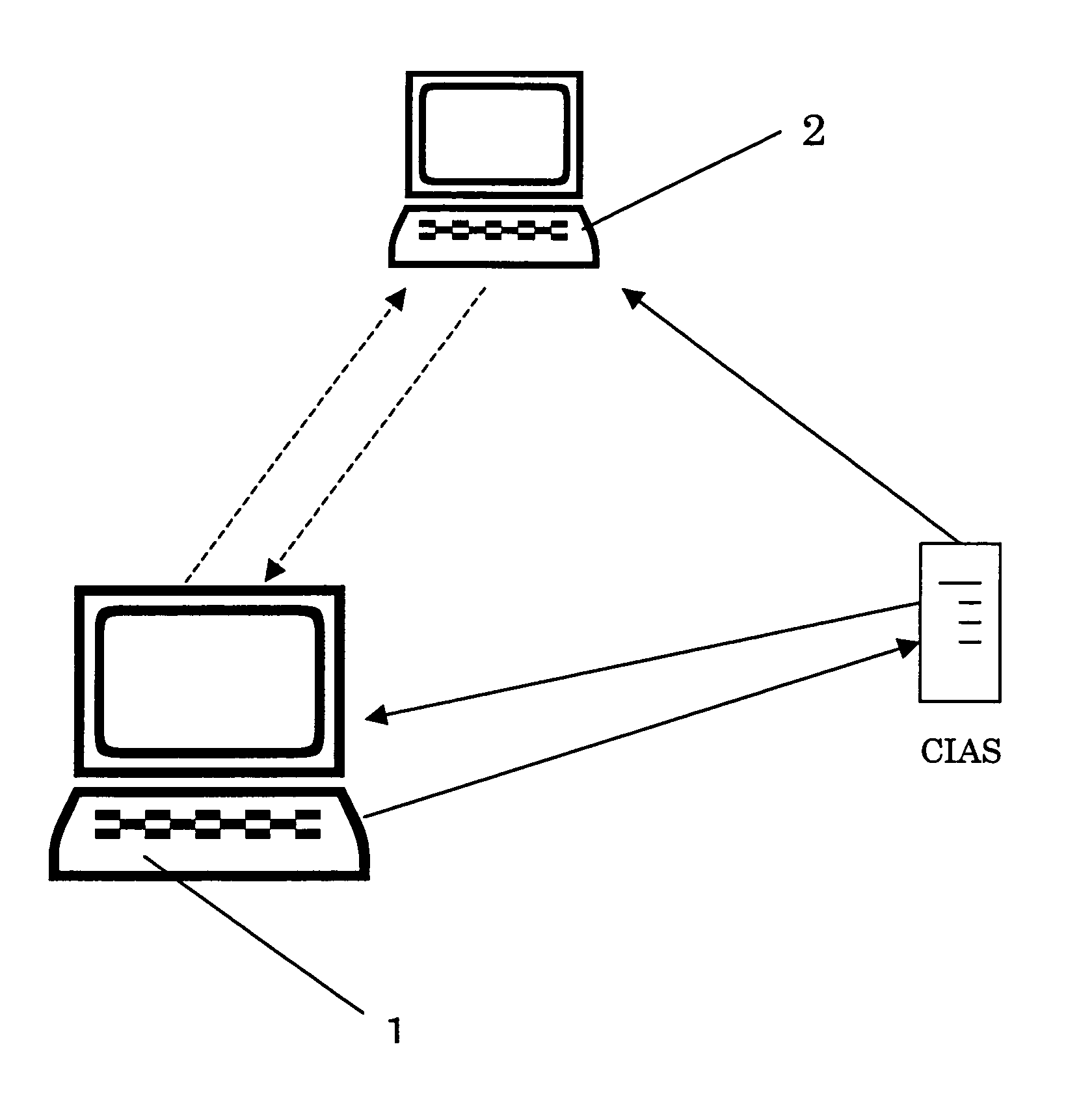

Electronic currency consists of data in a form suitable to be stored in a user's data storage medium, comprising information on the data value, identification of each specific set of data or data point, and authentication information suitable to verify that said data has been generated by a specific Currency Issuing Authority (CIA). A method and a system for effecting currency transactions between two users over the Internet or other communication network are also described.

Owner:MONEYCAT

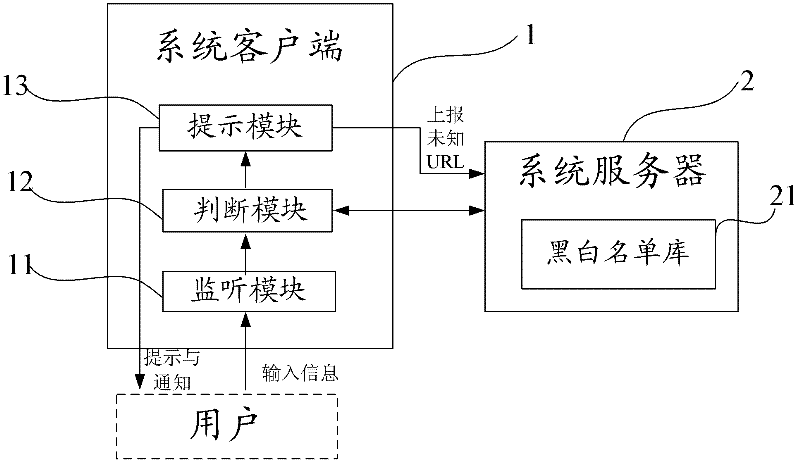

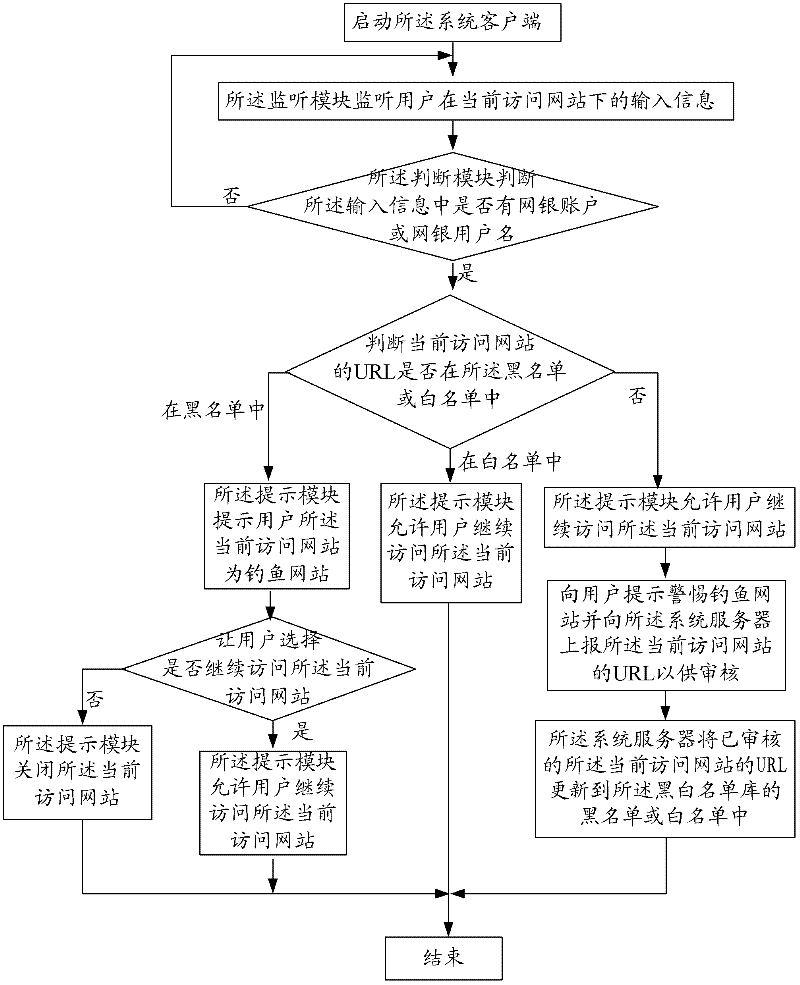

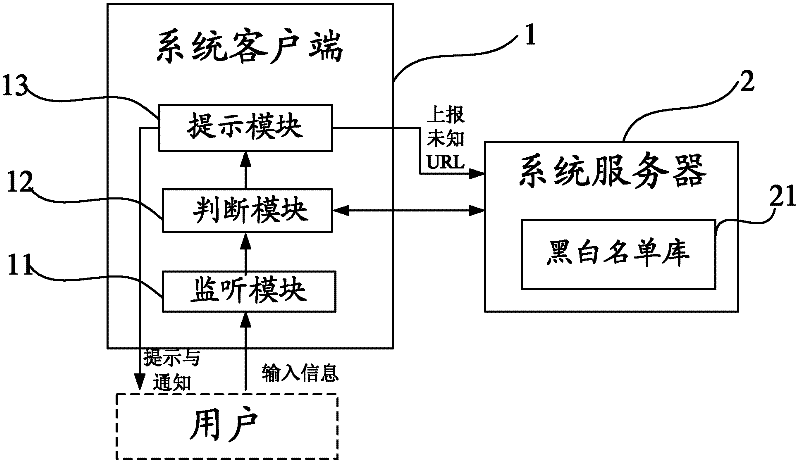

A network transaction security system and method

InactiveCN102299918AImprove accuracyImprove timelinessPayment architectureTransmissionCredit cardUser input

The present invention provides a network transaction security system and method. The monitoring module monitors user input in real time so that the judging module can judge in real time whether the currently visited website is a phishing website, and the prompt module quickly sends a vigilant prompt to the user and informs the unknown URL of the currently visited website. Report for review to update to the black and white list database, which improves the correct rate of identifying phishing websites and blocking access, and greatly reduces the probability of huge losses caused by theft of the user's online banking account. It is applicable to various bank cards, credit cards, and social security cards. Anti-phishing for online transactions such as game point cards, recharge cards, shopping cards and electronic money, with wide coverage, multiple notification methods and channels, and high timeliness.

Owner:SHENGQU INFORMATION TECH SHANGHAI

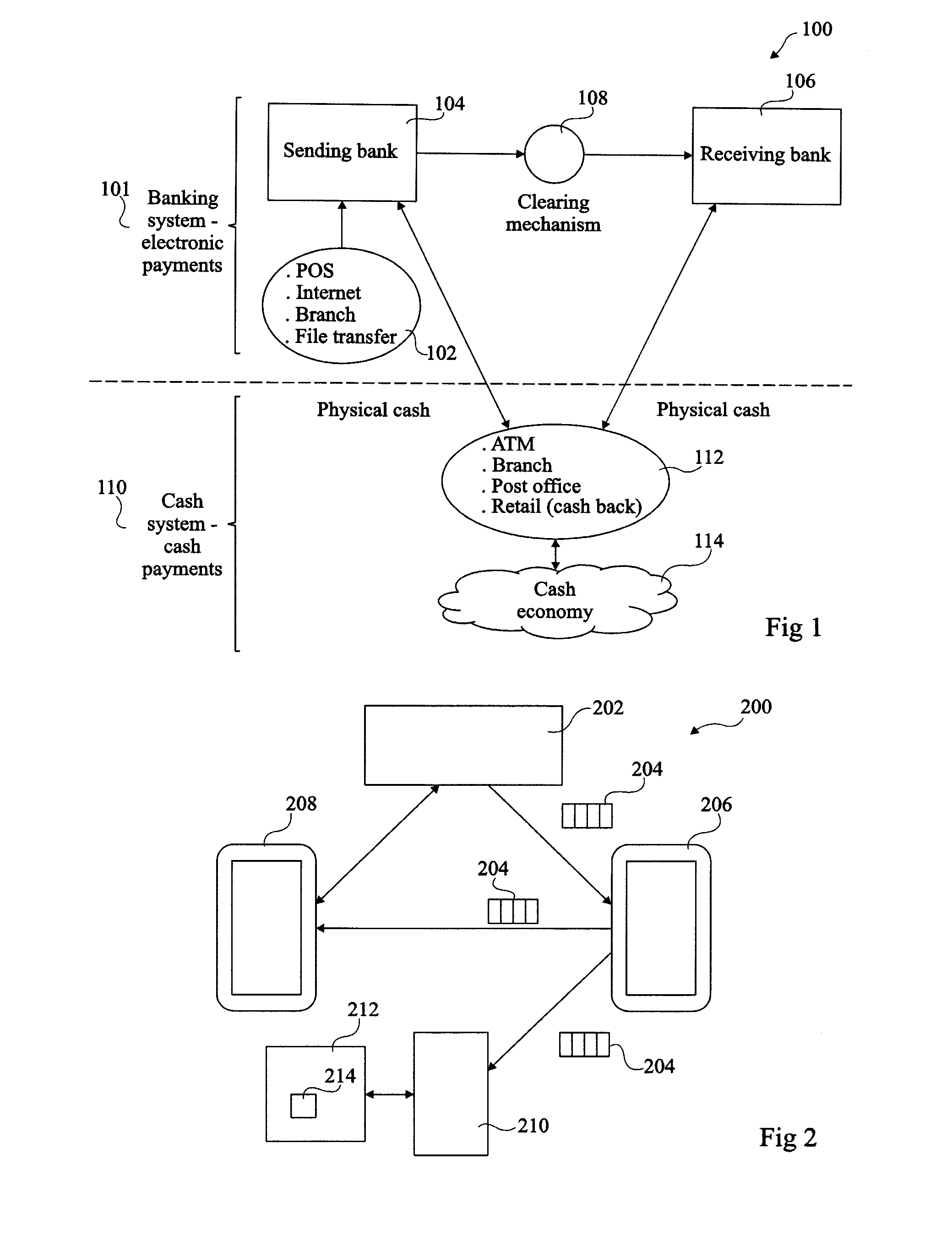

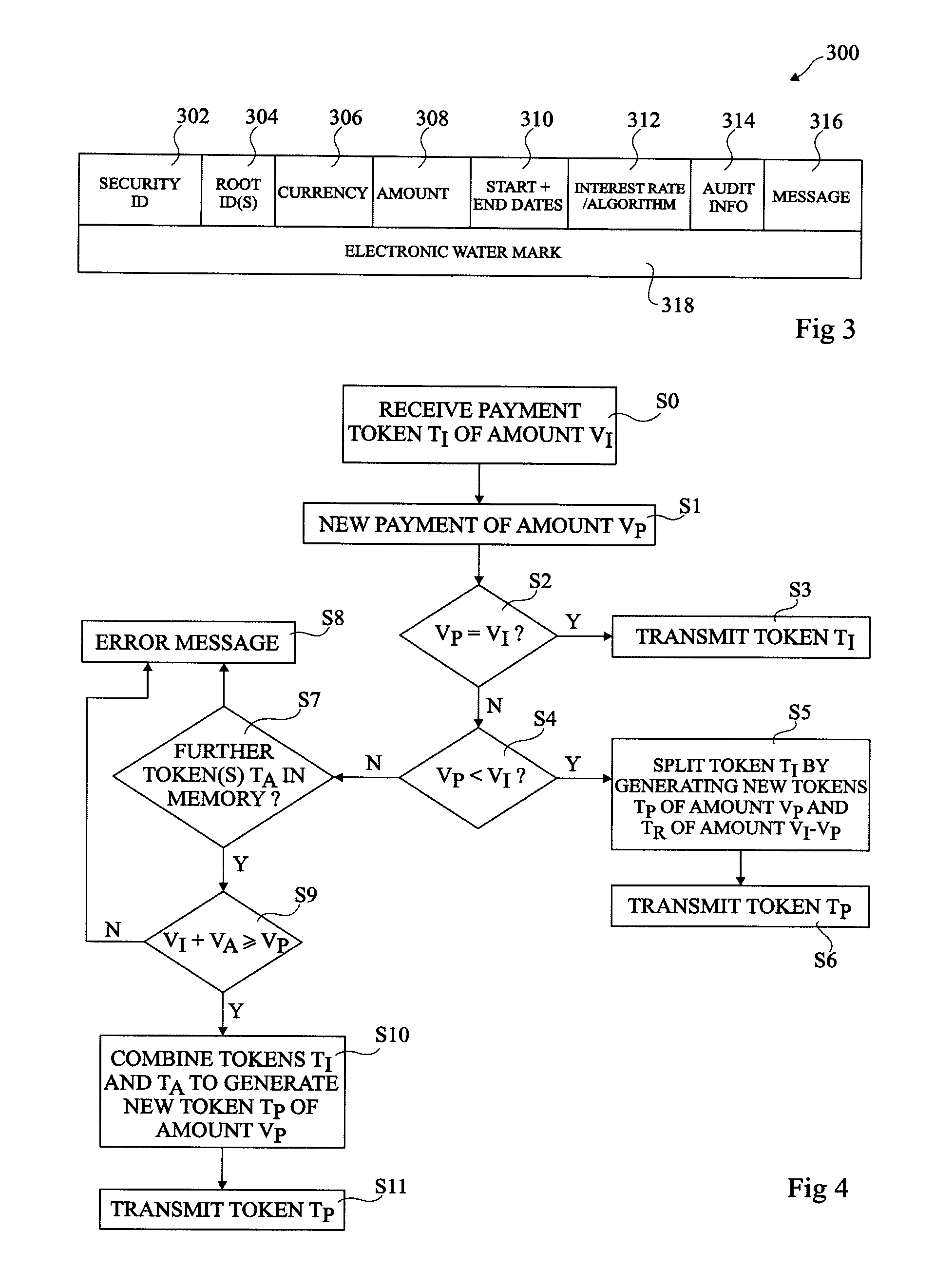

Dynamic electronic money

The invention concerns a method of making an electronic payment by an electronic payment device comprising: transmitting from said electronic payment device (206) to an electronic receiving device (208, 210) a first money token (204) comprising at least data indicating an identifier of said first money token and an amount indicating a payment sum of said first money token, wherein said first money token further comprises an electronic watermark.

Owner:ACCENTURE GLOBAL SERVICES LTD

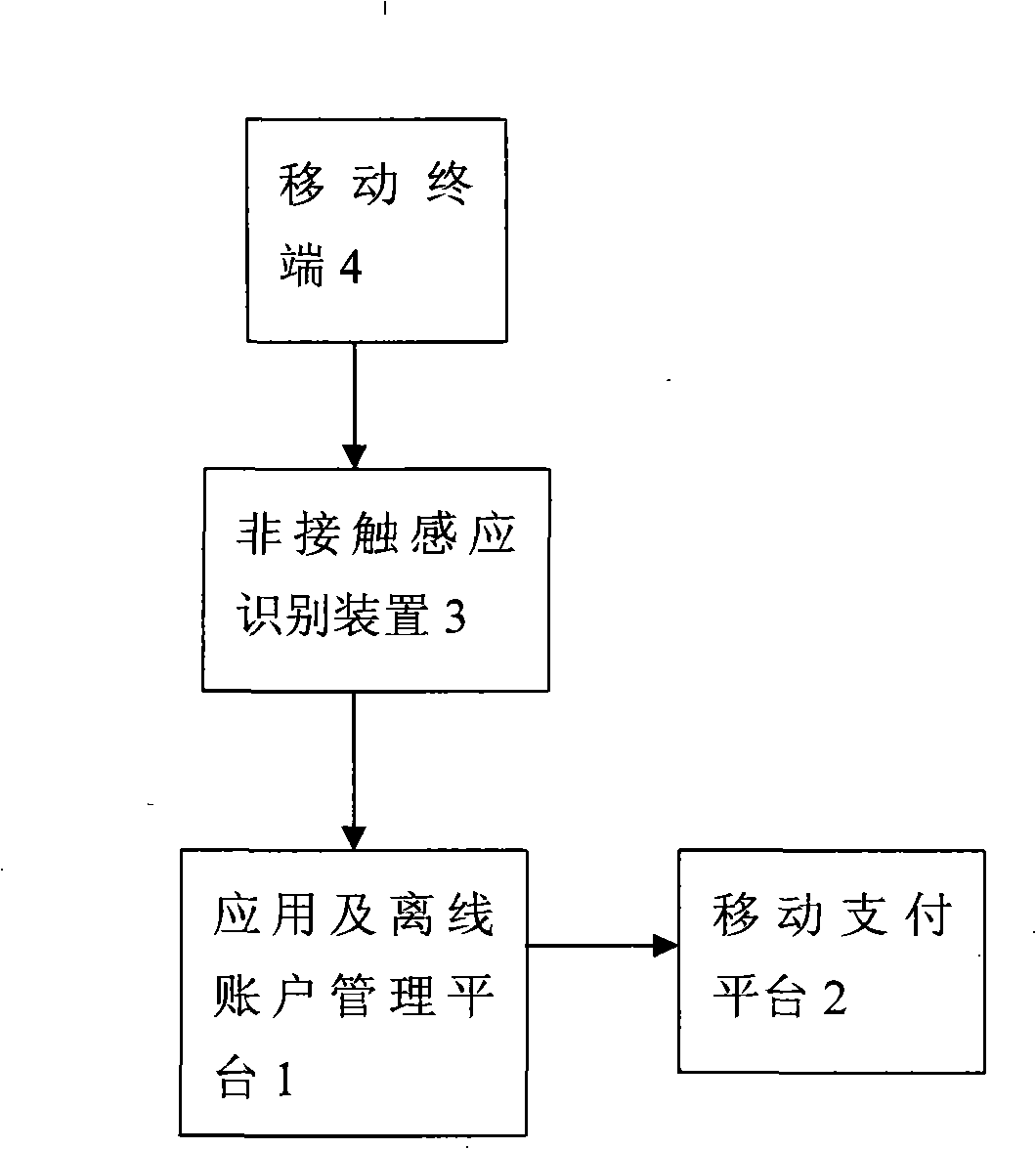

Non-contact card application management system and management method based on mobile communication

InactiveCN101359383APrecision marketingEliminate the disadvantages of carrying a large number of different IC cardsPayment architectureIdentification devicePrecision marketing

The invention provides a contactless card application management system and a management method; the system includes an application and offline accountant management platform (1), a mobile payment platform (2) and a mobile terminal (4); the application and offline accountant management platform (1) is mutually connected with the mobile payment platform (2); the mobile terminal (4) is connected with the application and offline accountant management platform (1) through a contactless induce-identify device (3); the mobile terminal (4) accesses to the mobile communication network of the mobile payment platform (2). The invention adopts the wireless communication device as the electronic currency of various electronic payment platforms so that the defect of carrying large quantities of different IC cards is solved for the users; the consumption behavior of the users can be analyzed; the precision consumption information is delivered to the users according to the consumption behavior and the interests of the users, so as to provide precision marketing bidirectional service for the merchants and users and further promote the development of the electronic payment mode.

Owner:CHINA MOBILE GRP GUANGDONG CO LTD

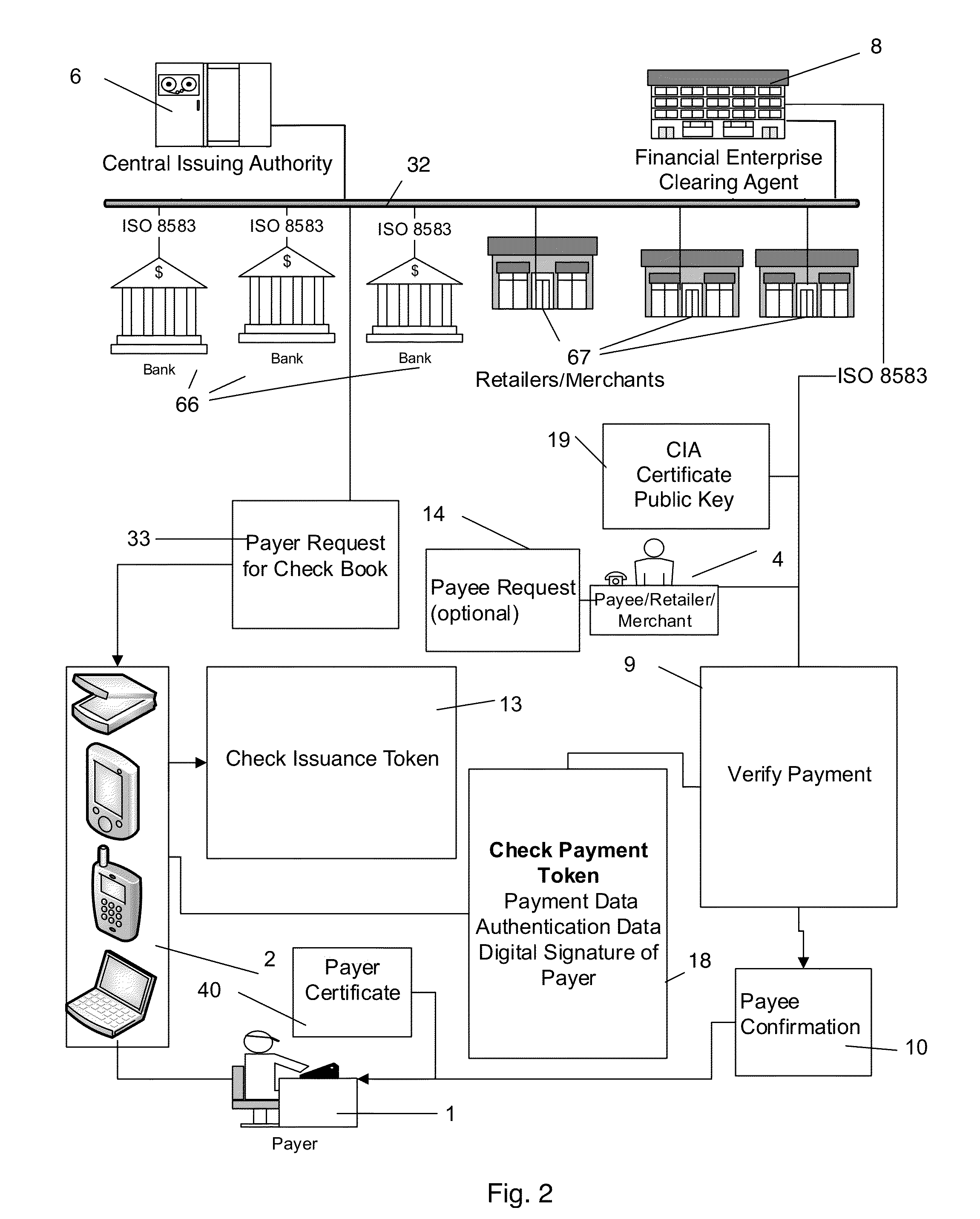

Electronic payment and authentication system

InactiveUS20150120536A1Enhance wireless paymentBetter user identificationFinancePayment protocolsChequeAuthentication system

The invention relates to electronic currency transactions, facilitated by electronic equivalents of checks and credit / debit cards. The electronic equivalents are encrypted tokens, which are data units suitable for storage in and transfer between participants' data storage devices. The invention provides an electronic payment system having Check- and Card-Issuing Authorities that are coupled to a token-generating server. Electronic checks and credit / debit cards, backed by correspondent Check- and Card-Issuing Authorities, are generated and issued to subscribing customers as issuance tokens. A plurality of token-generating devices are used by participants to generate payment tokens authorized by the issuance tokens, and to perform electronic check and card transactions by exchanging tokens with other participants and participating Financial Institutions. The invention provides methods for authentication and verification of the token data, for maintaining the integrity of the system, and for detecting and preventing counterfeiting and tampering within the system.

Owner:TALKER ALBERT

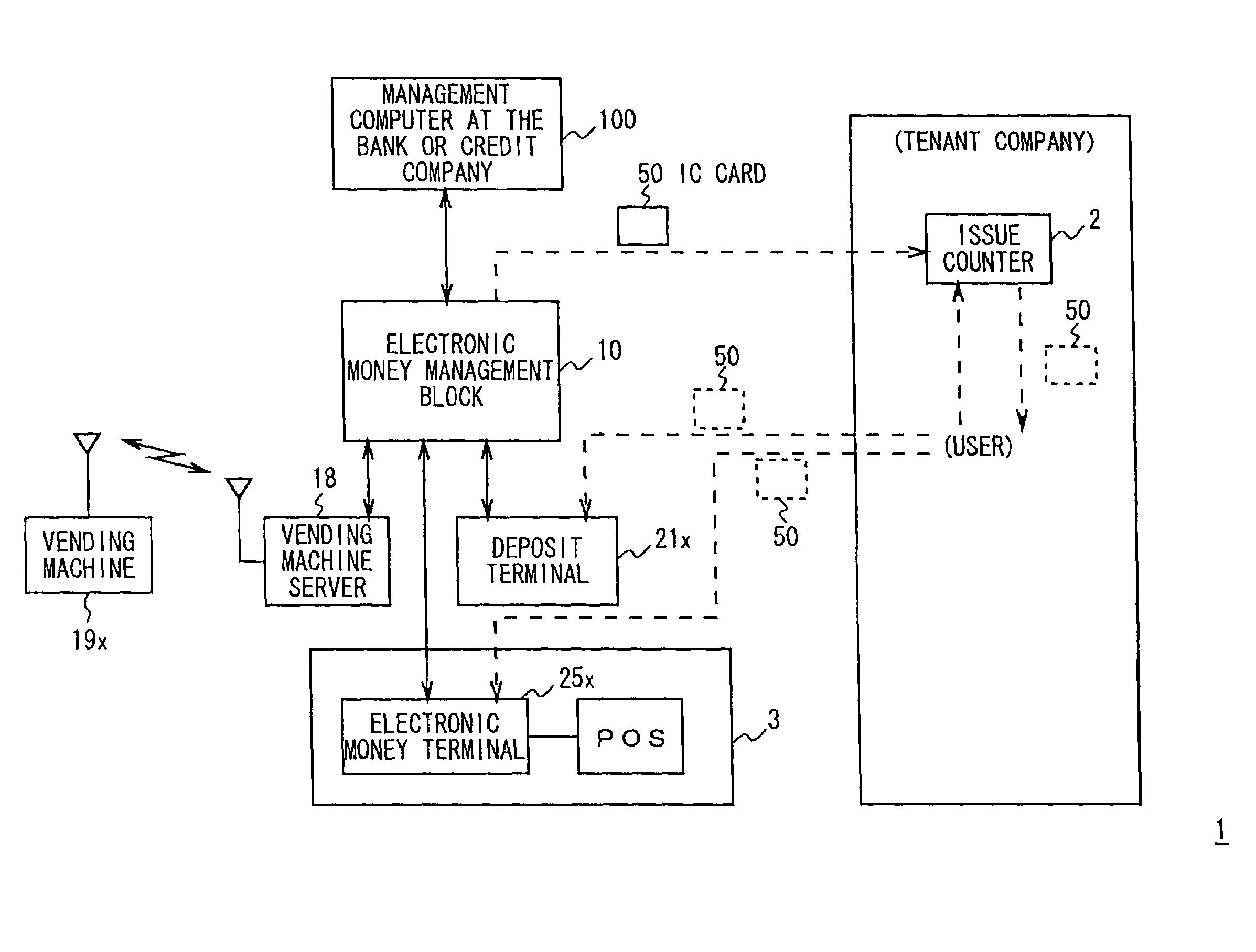

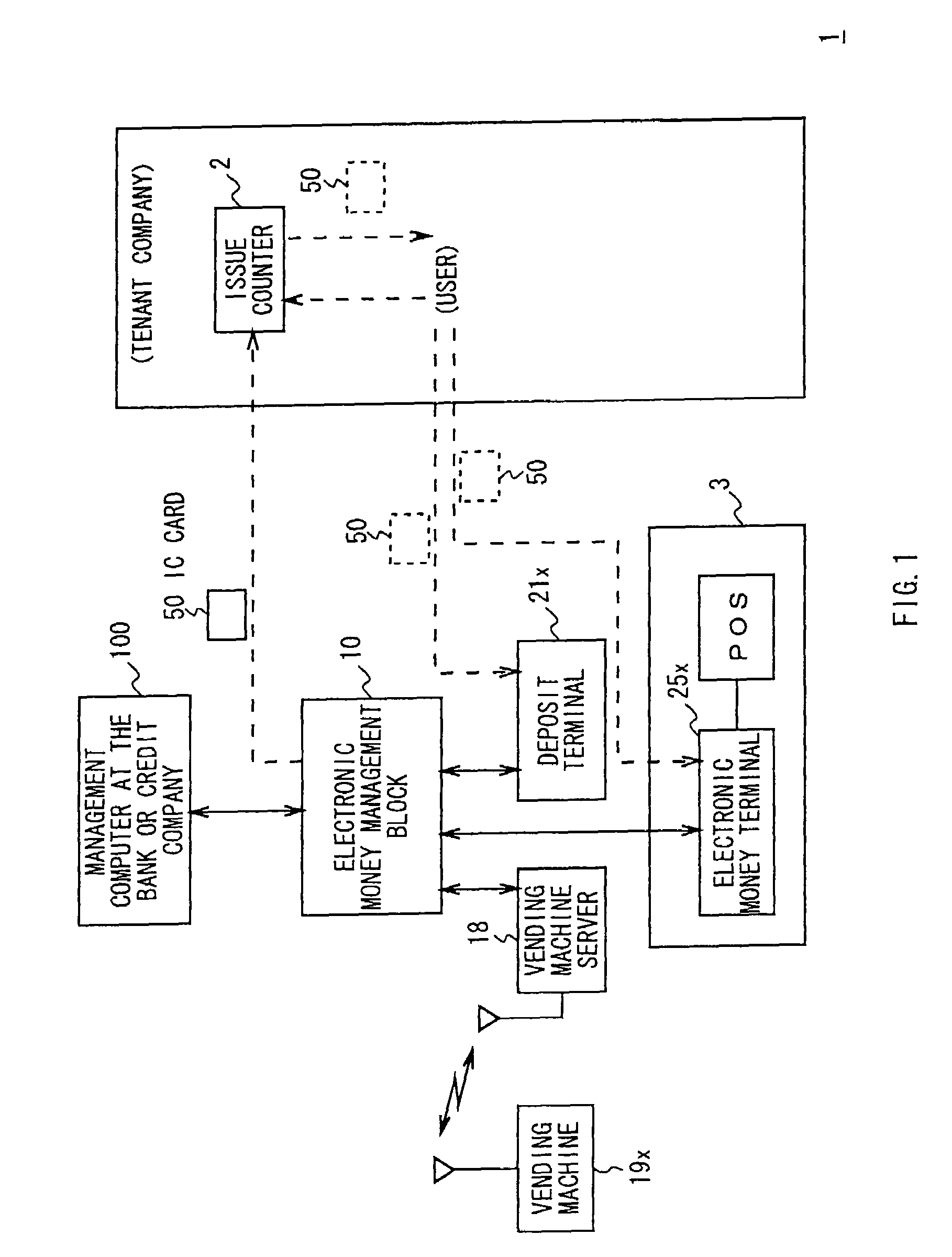

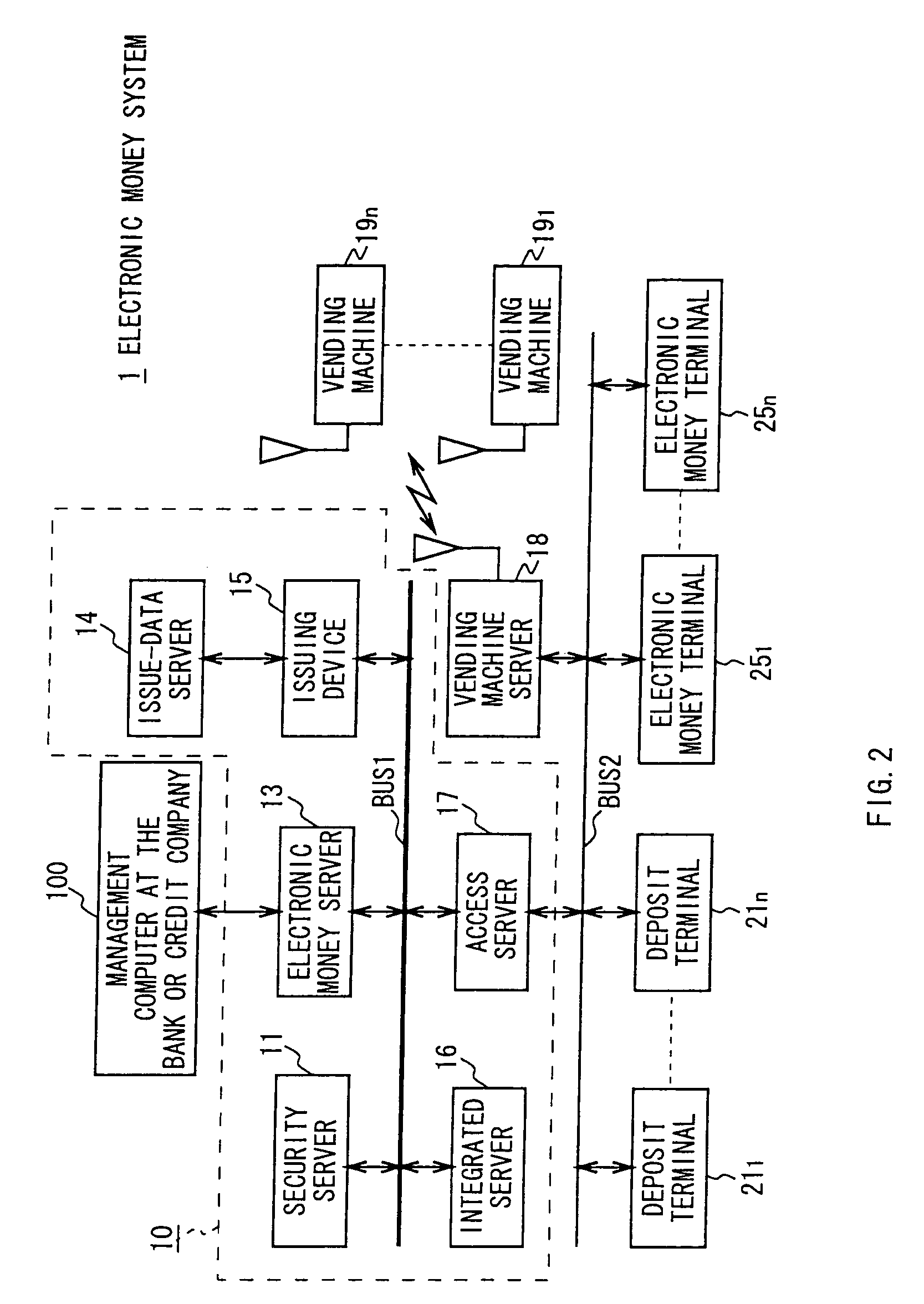

Electronic money system and electronic money terminal device

The present invention offers an electronic money system and electronic money terminal that allow the user who uses an installment payment plan to decide the installment amount each time he / she pays it.Instead of debiting the amount data equivalent to consumption from an information card 50, the present invention accumulates the amount data equivalent to consumption as data on the transaction history of installment payments, receives part or all of the accumulated installment balance as an installment amount, subtracts the received installment amount from the installment balance to determine a new balance, and thereby allows the user to pay any part of the installment balance as an installment amount.

Owner:SONY CORP

Account free possession and transfer of electronic money

The account free possession and transfer of electronic money. Payment with E-Money is a settlement free process. Ownership and transfer occurs by means of name (identification number or URL) of the electronic bill and secure password. A person who knows the name and the password owns the money. Upon change of ownership the password has to be changed. The password change occurs on the server and the rest of the process in the individual wallet application or is processed manually by the user of E-Money.

Owner:OCHYNSKI WALTER

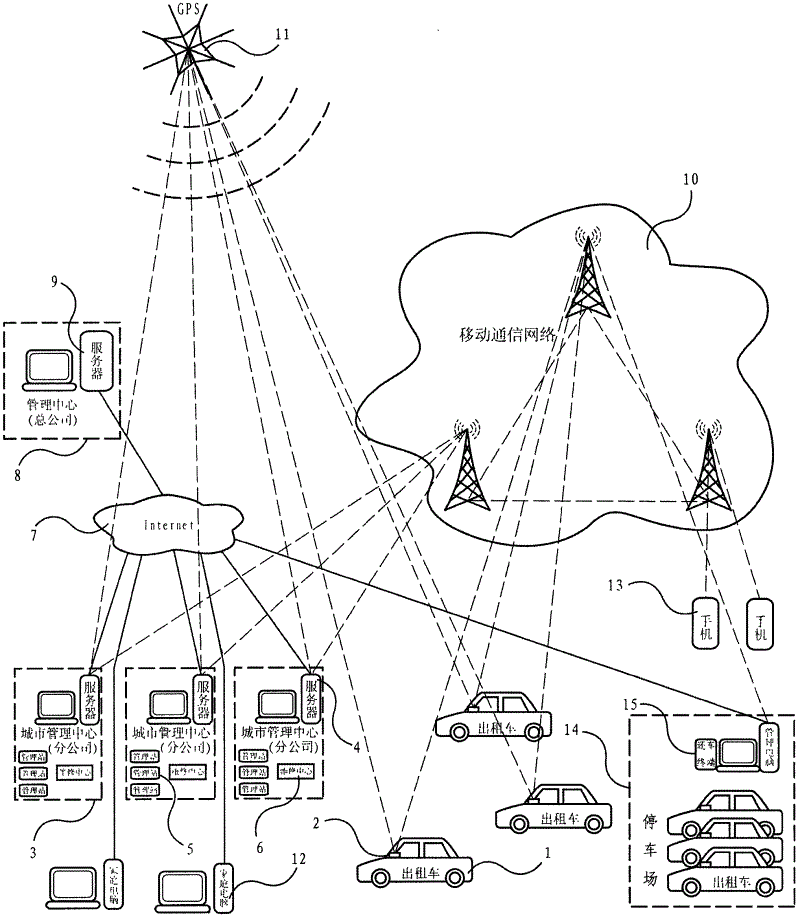

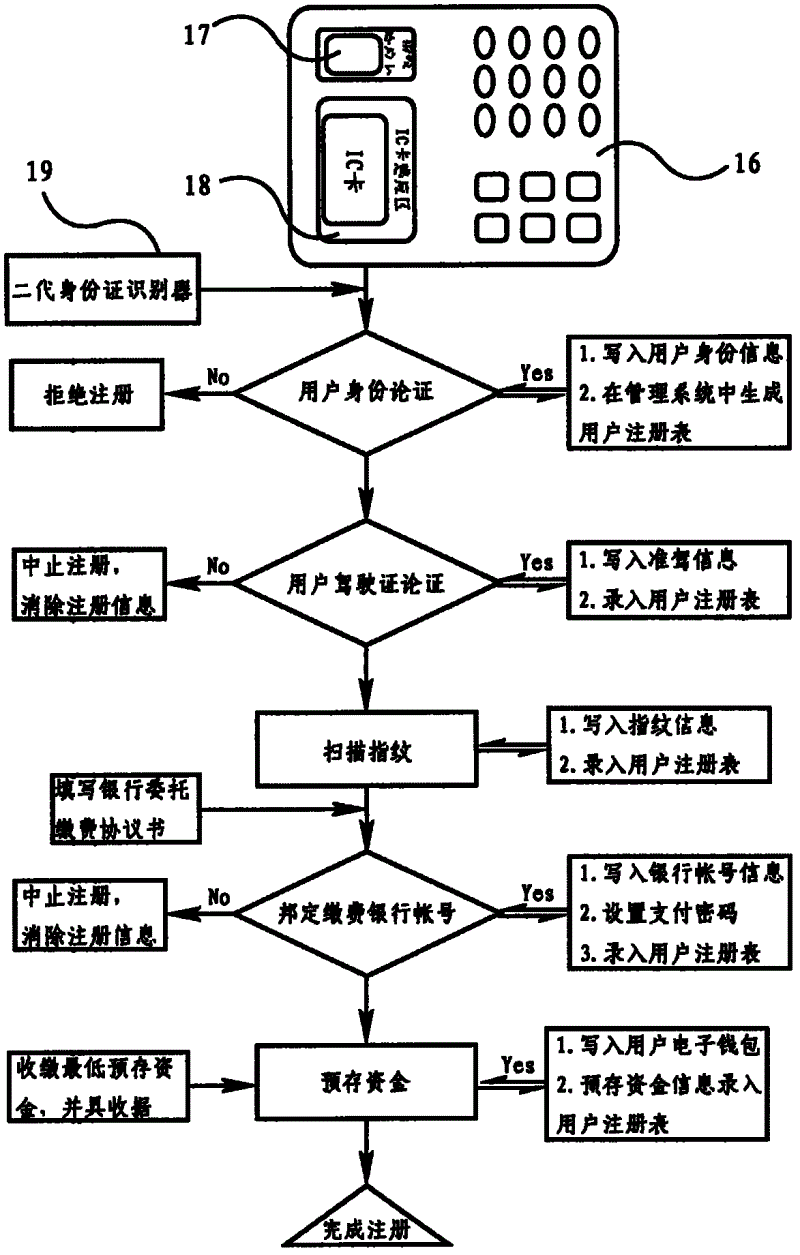

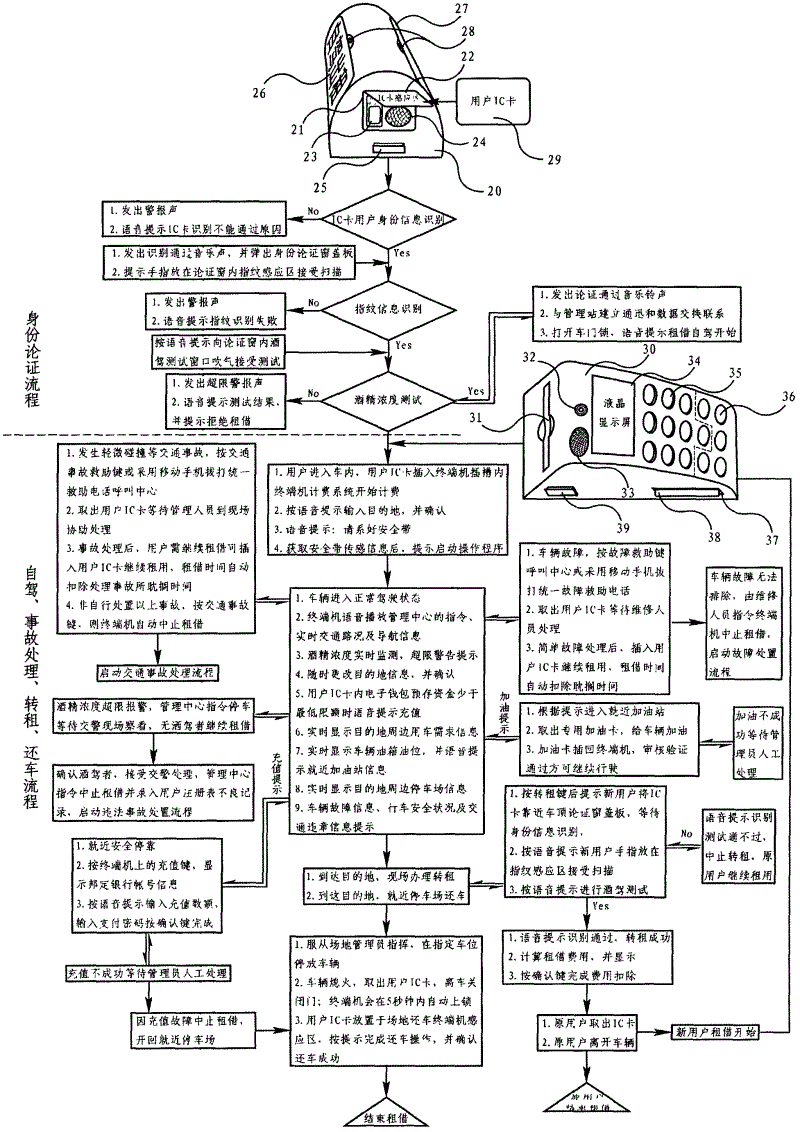

Self-service vehicle renting management system and self-service vehicle renting management method

InactiveCN102622704AGuaranteed uptimeImprove reliabilityPre-payment schemesBuying/selling/leasing transactionsThe InternetEngineering

The invention provides a self-service vehicle renting management system and a self-service vehicle renting management method. The management system is based on technologies in terms of GPS (global positioning system) / GSM (global system for mobile communication) positioning systems, mobile communication systems, the internet, IC (integrated circuit) cards and the like. Self-service vehicle renting is realized by the aid of the management system and the management method, a user can use a user IC card stored with information including an identity card, a driving license, fingerprints and pre-stored fee to rent, transfer and return any vehicle in any one renting and returning (parking) lot within a network coverage range at any time and in any places, electronic money real-time settlement and any-time recharging are realized, and accordingly vehicle renting, returning and settlement are convenient, fast, safe and reliable. The self-service vehicle renting management method can be carried out nationwide, the user can rent a vehicle, return the vehicle, recharge and settle accounts in management centers of various cities only by the aid of the user IC card, and accordingly the vehicles are rented and returned highly freely temporally and spatially.

Owner:ZHEJIANG UNIVERSITY OF SCIENCE AND TECHNOLOGY

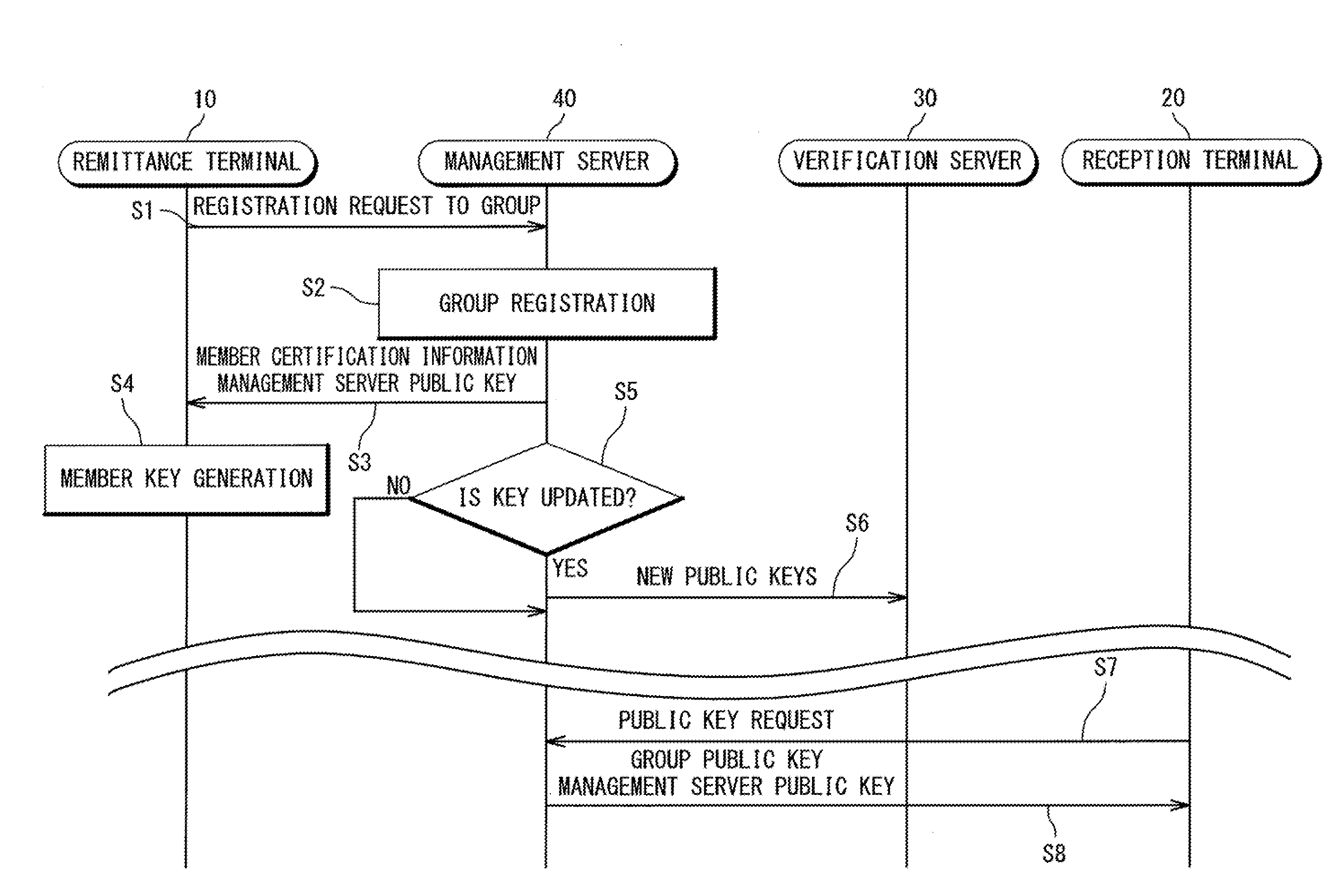

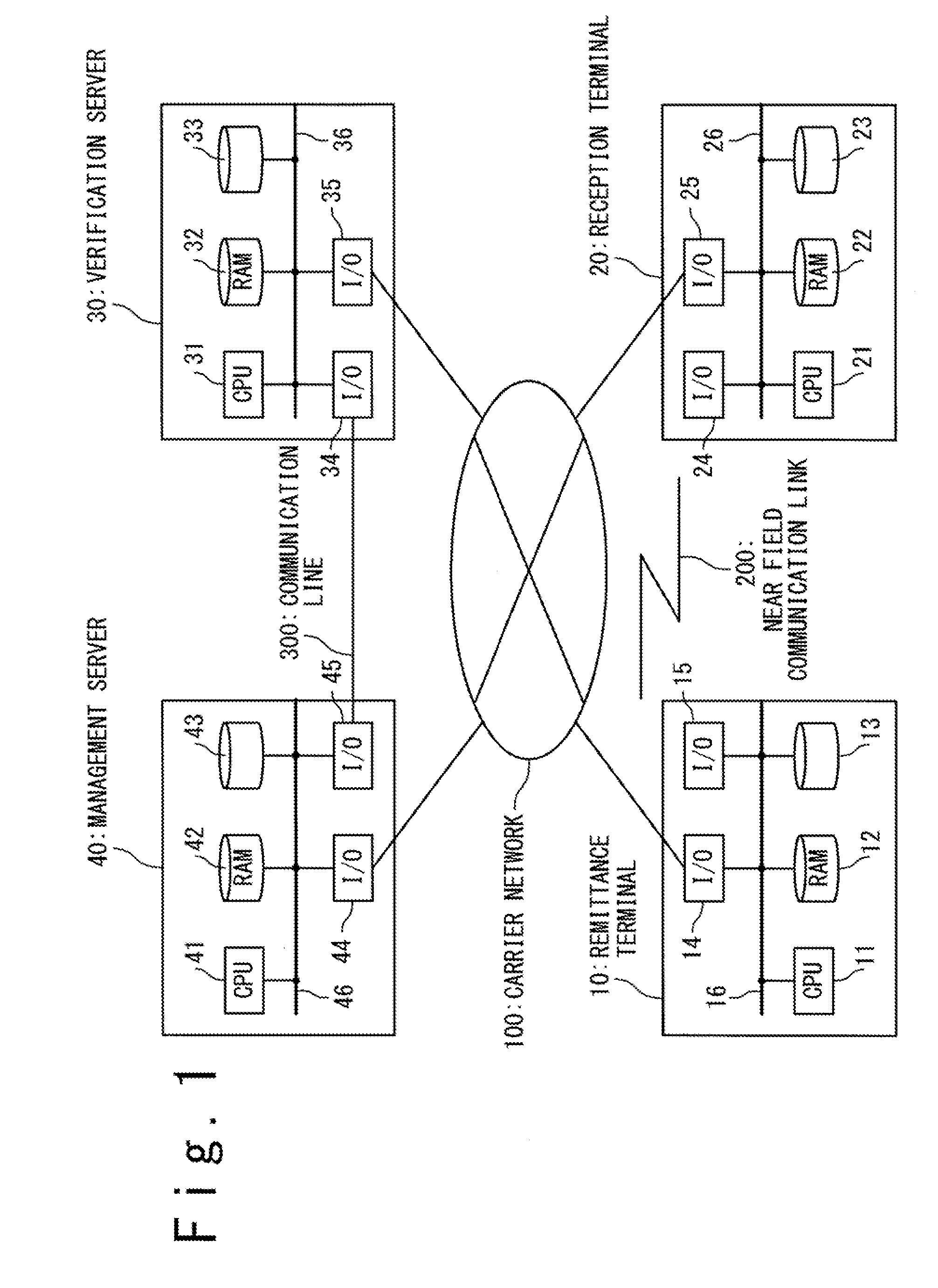

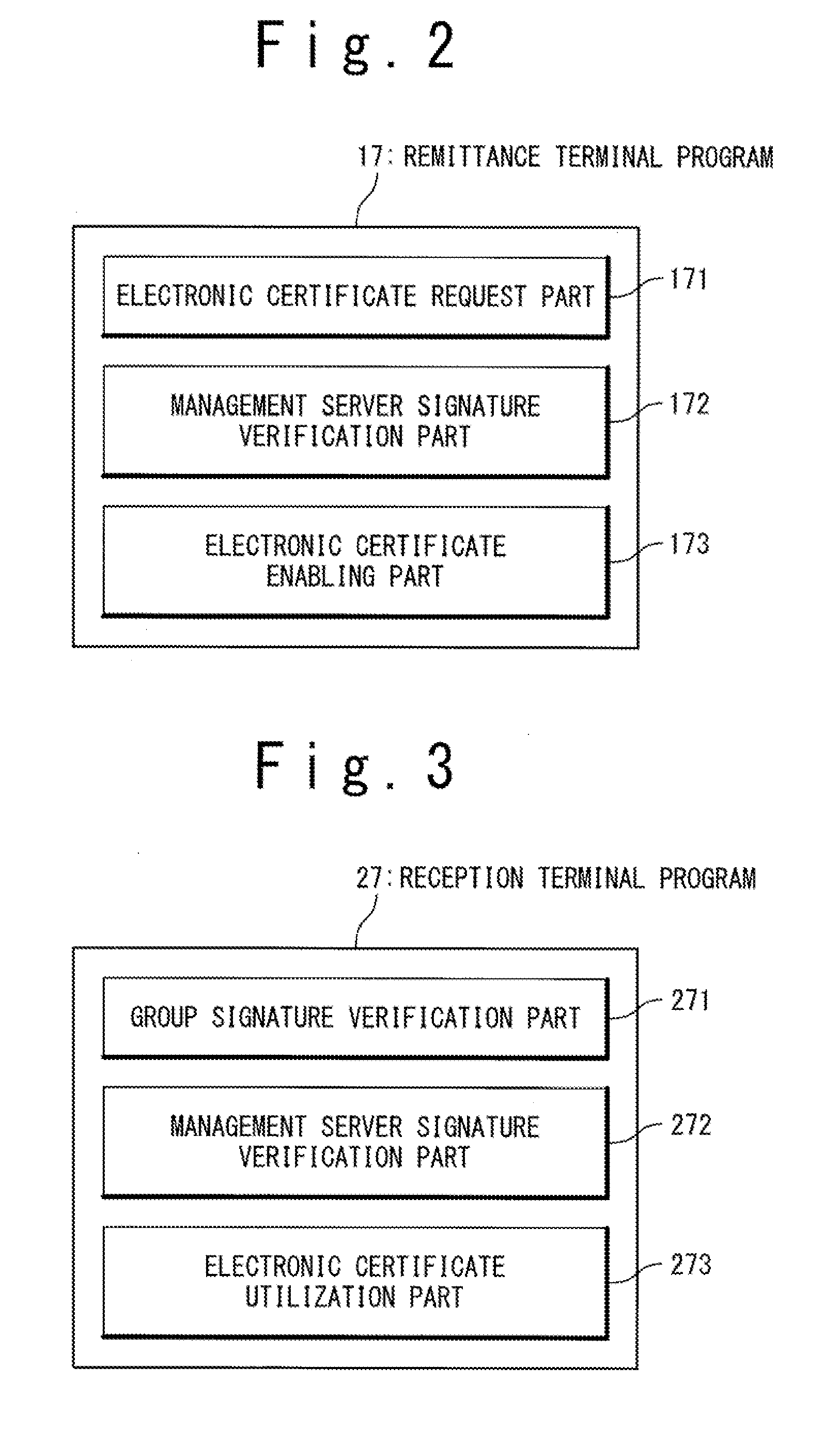

Electronic money system and electronic money transaction method

ActiveUS20100217710A1Illegal useComplete banking machinesNear-field transmissionComputer terminalComputer security

An electronic money system is directed to avoid unauthorized use of certificate-type electronic money. The electronic money system is provided with a management server, a verification sever, a remittance terminal, and a receptor terminal. In response to a request from the remittance terminal, the management server issues an inactive electronic certificate including a certificate ID and notifies the verification server of the certificate ID. The remittance terminal gives a group signature to the inactive electronic certificate to generate an active electronic certificate. The reception terminal verifies the active electronic certificate obtained from the remittance terminal on the basis of the group signature. The verification server matches the certificate ID notified from the management server with the certificate ID included in the active electronic certificate verified by the reception terminal to verify availability of the active electronic certificate.

Owner:NEC CORP

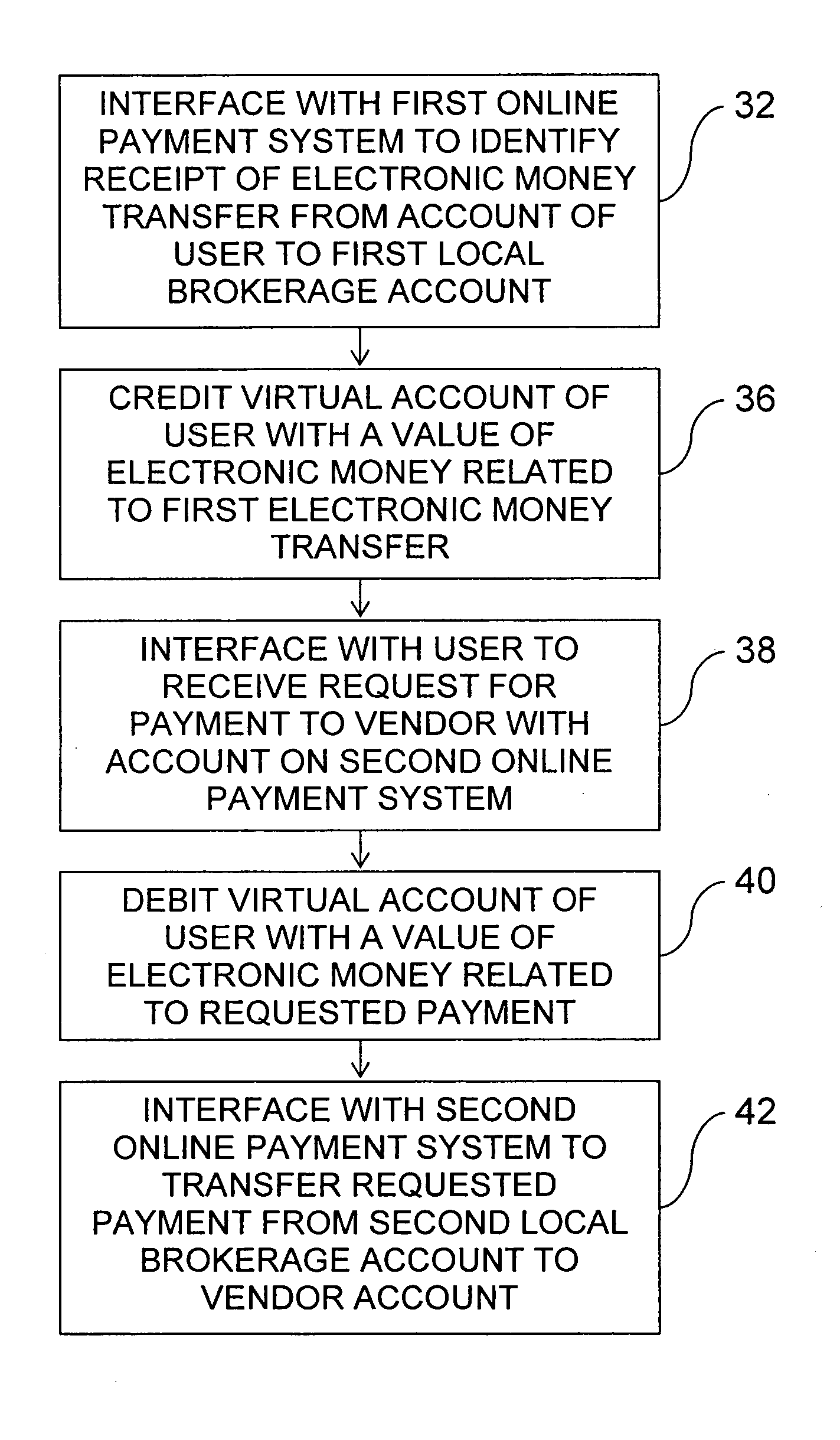

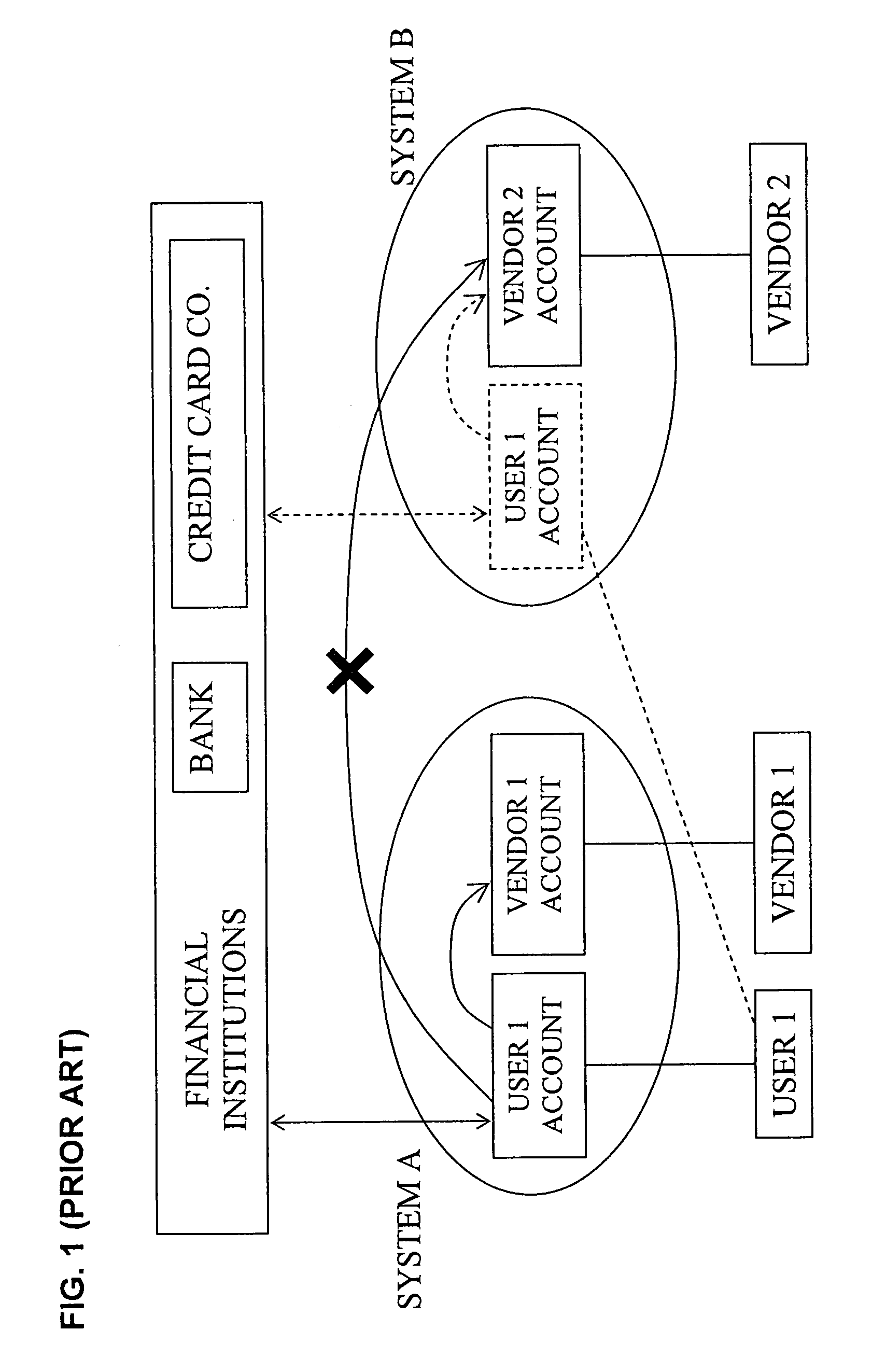

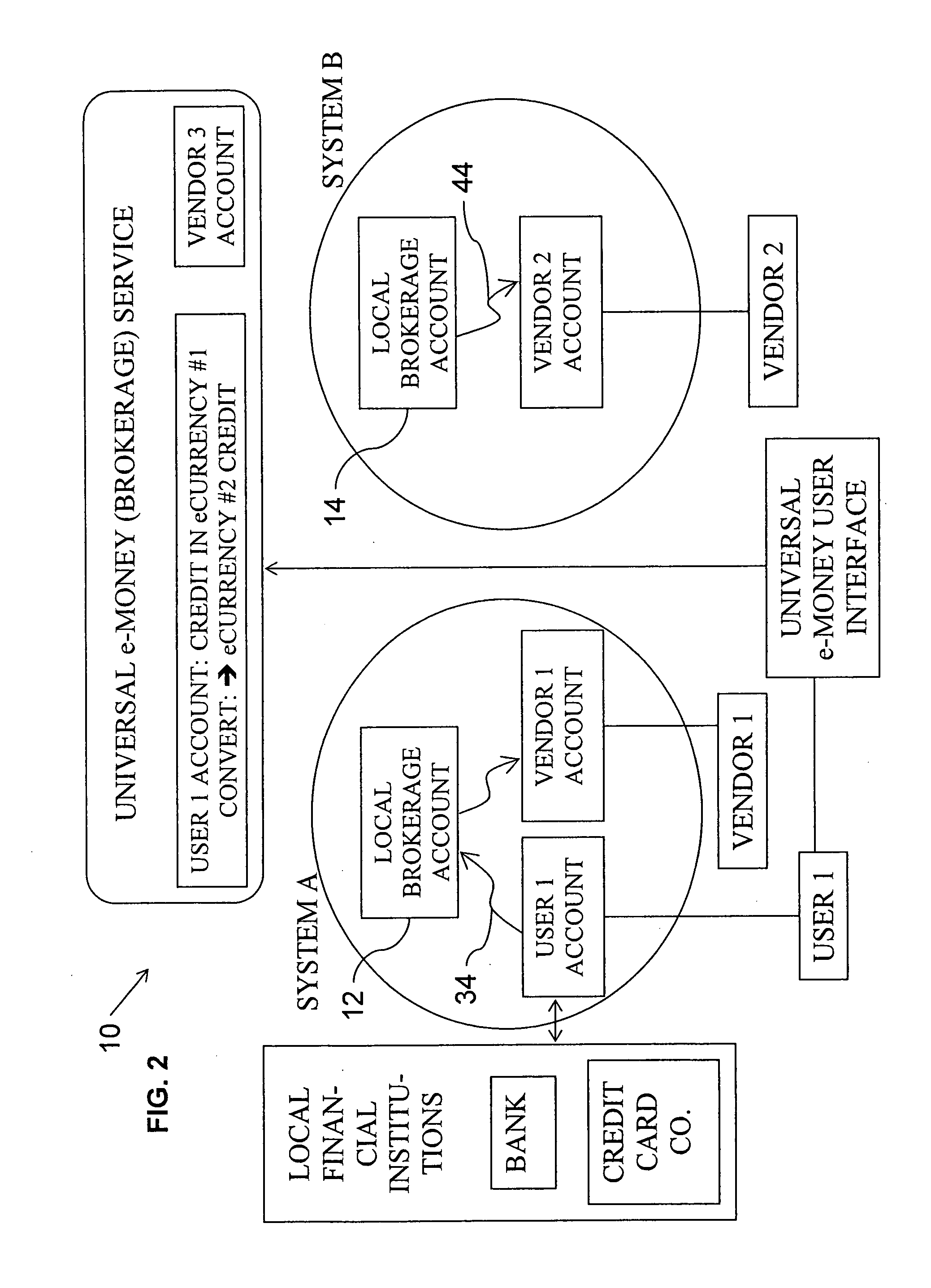

Universal e-money brokerage service and method

A universal e-money system and corresponding method for financial transactions involving different online payment systems includes local brokerage accounts opened with each online payment system, and software modules programmed in a computer in communication with the online payment systems. The modules interface with a first online payment system to identify receipt from a user of the first online payment system of a first electronic money transfer to a first local brokerage account and credit a virtual account of the user with a related value of electronic money. The modules also interface with the user to receive a request to complete a payment to a vendor having an account on a second online payment system. The virtual account of the user is debited and the requested payment is effected within a second online payment system from the local brokerage account to the vendor account.

Owner:DREPAK DAVID

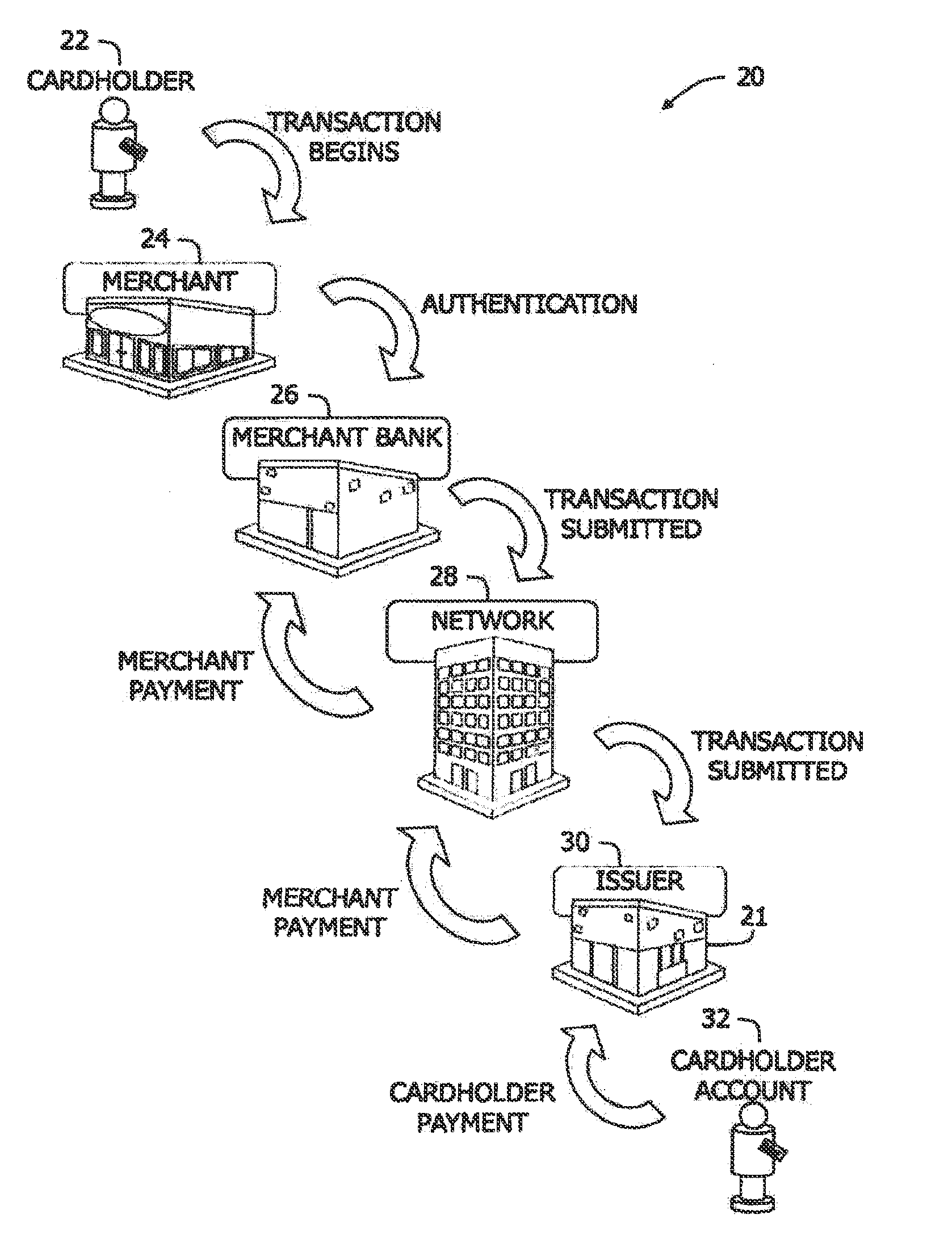

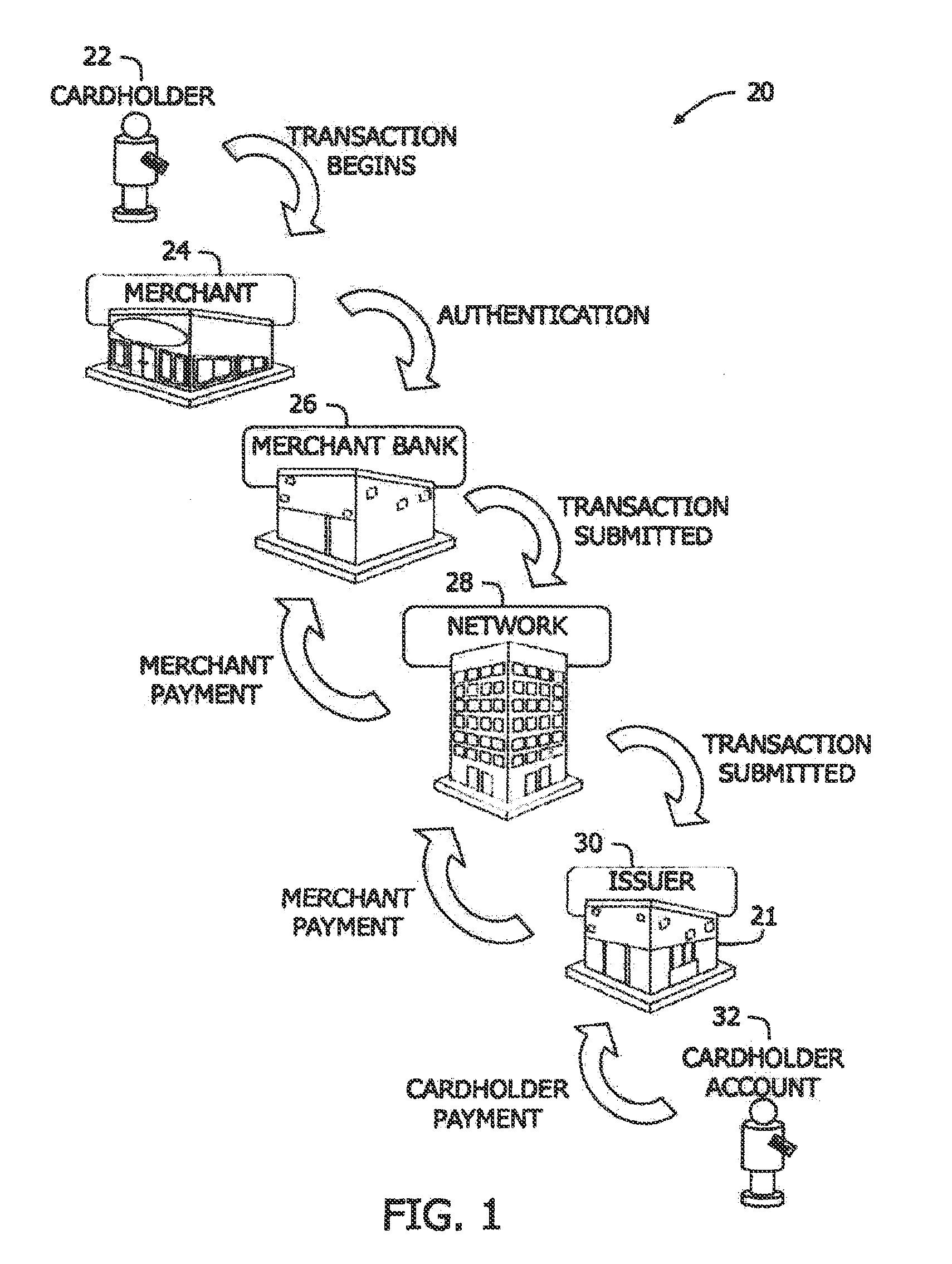

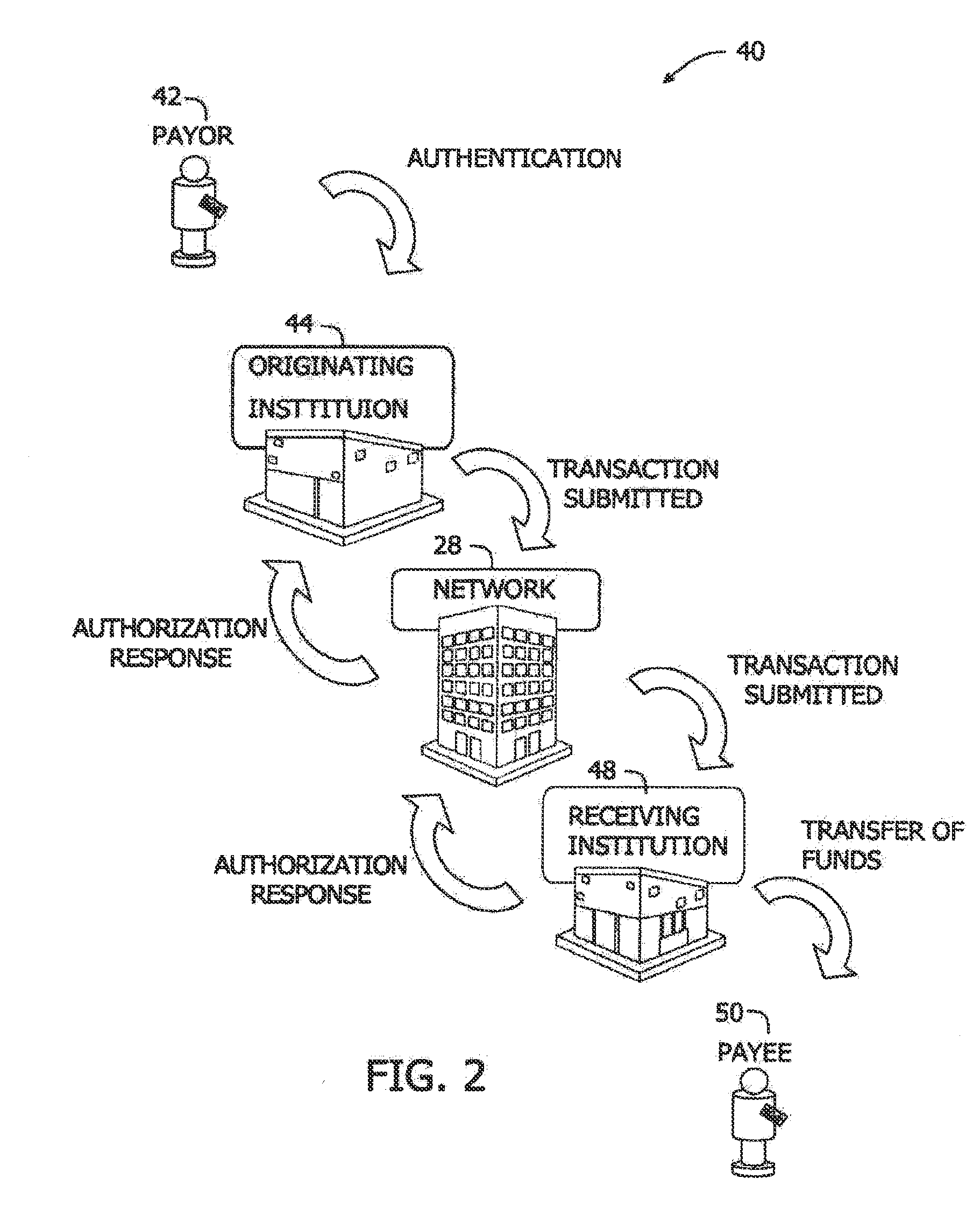

Methods and systems for screening electronic money transfer transactions

A computer-implemented method for processing a real-time money transfer with a screening payment network having a screening module communicatively coupled to a server computing device is provided. The method includes receiving a request to transfer funds from a payor account associated with an originating institution to a payee account associated with a receiving institution. The request includes money transfer data indicative of a payor's identifying information. The method also includes determining a sanction score based at least in part on the money transfer data, the sanction score indicative of the likelihood that the payor is on at least one sanctioned entity list. The method also includes transmitting the money transfer data and the sanction score to the receiving institution, and transmitting a response message to the originating institution, the response message indicating whether the receiving institution authorizes or denies the request to transfer the funds.

Owner:MASTERCARD INT INC

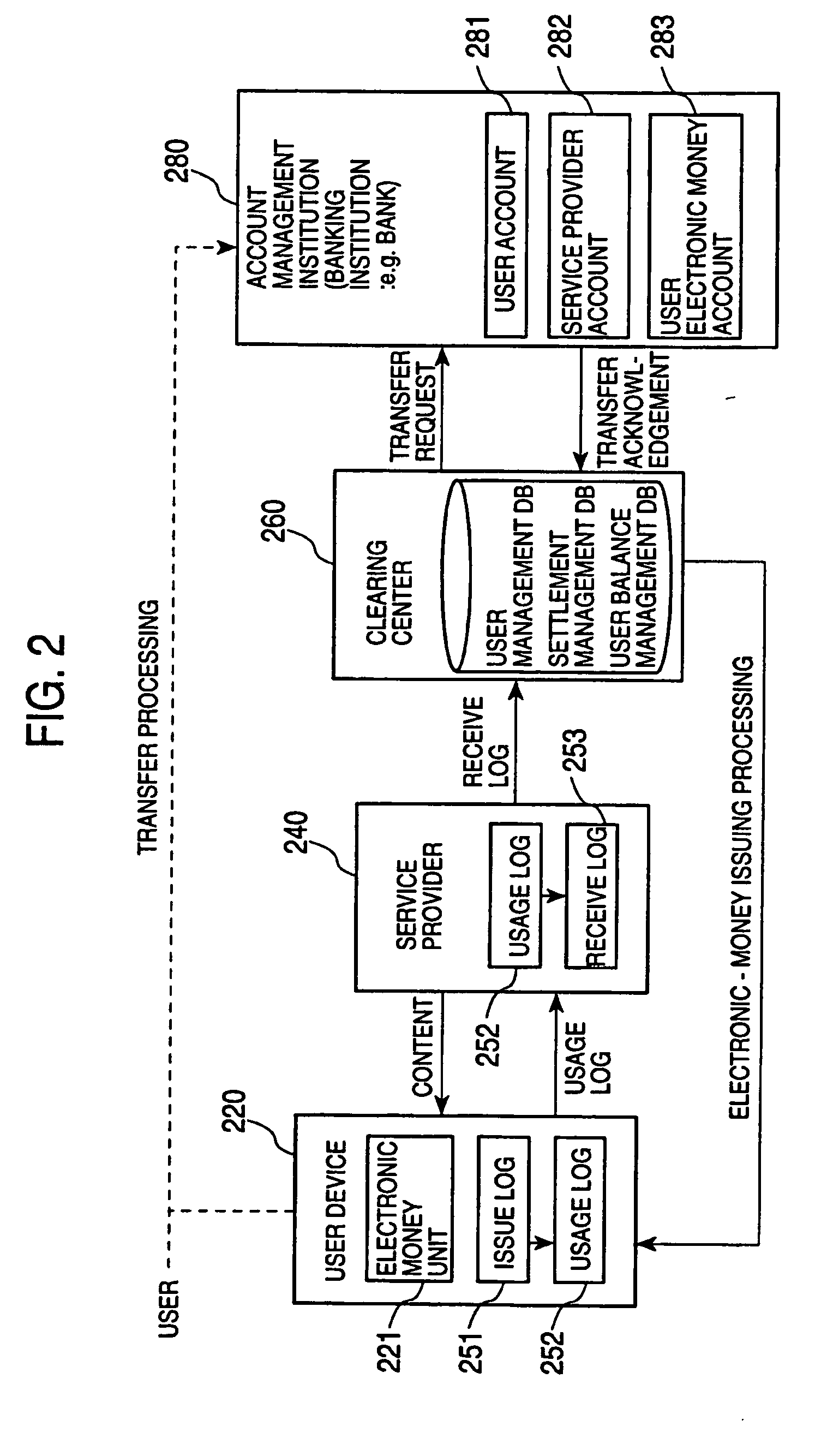

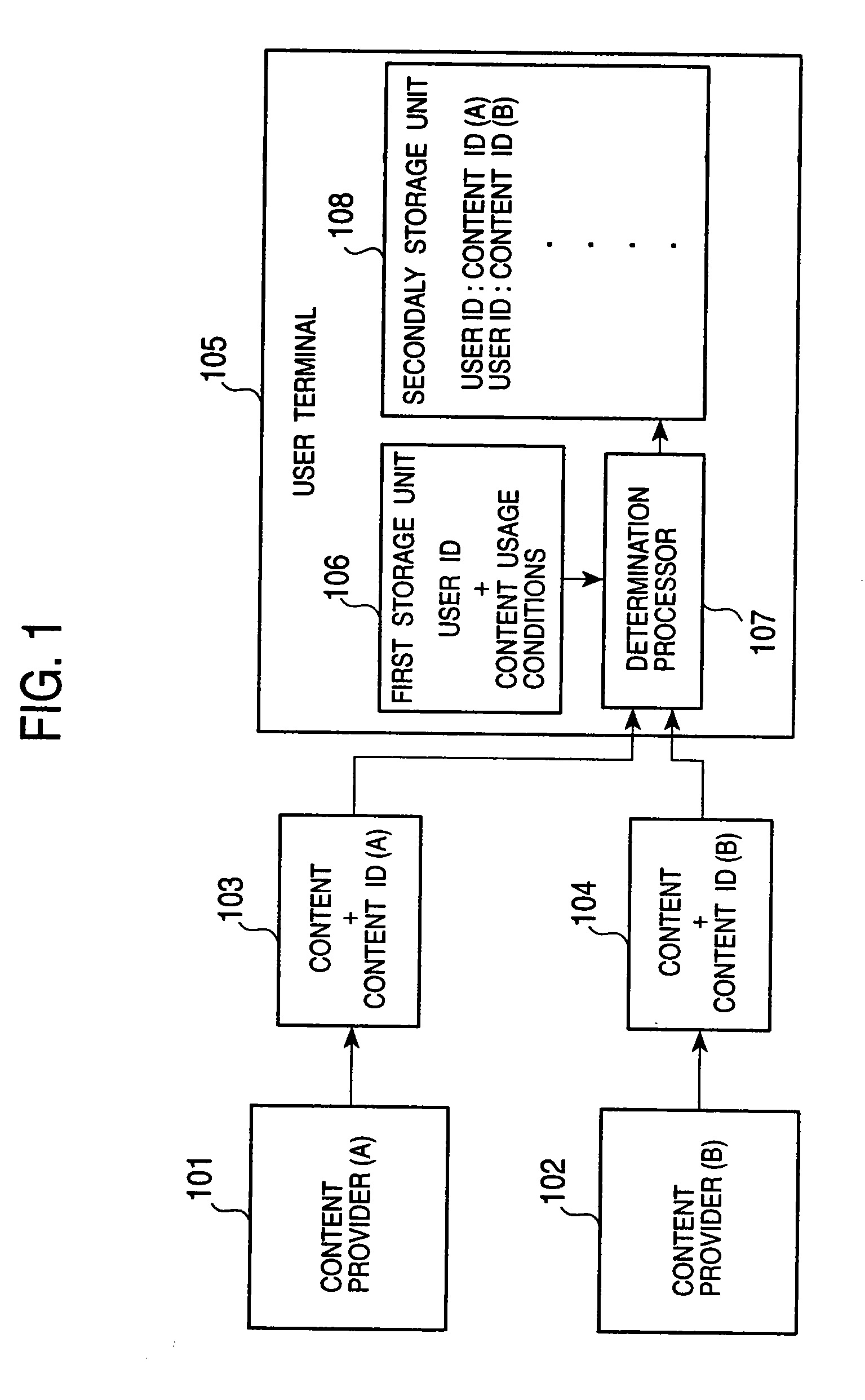

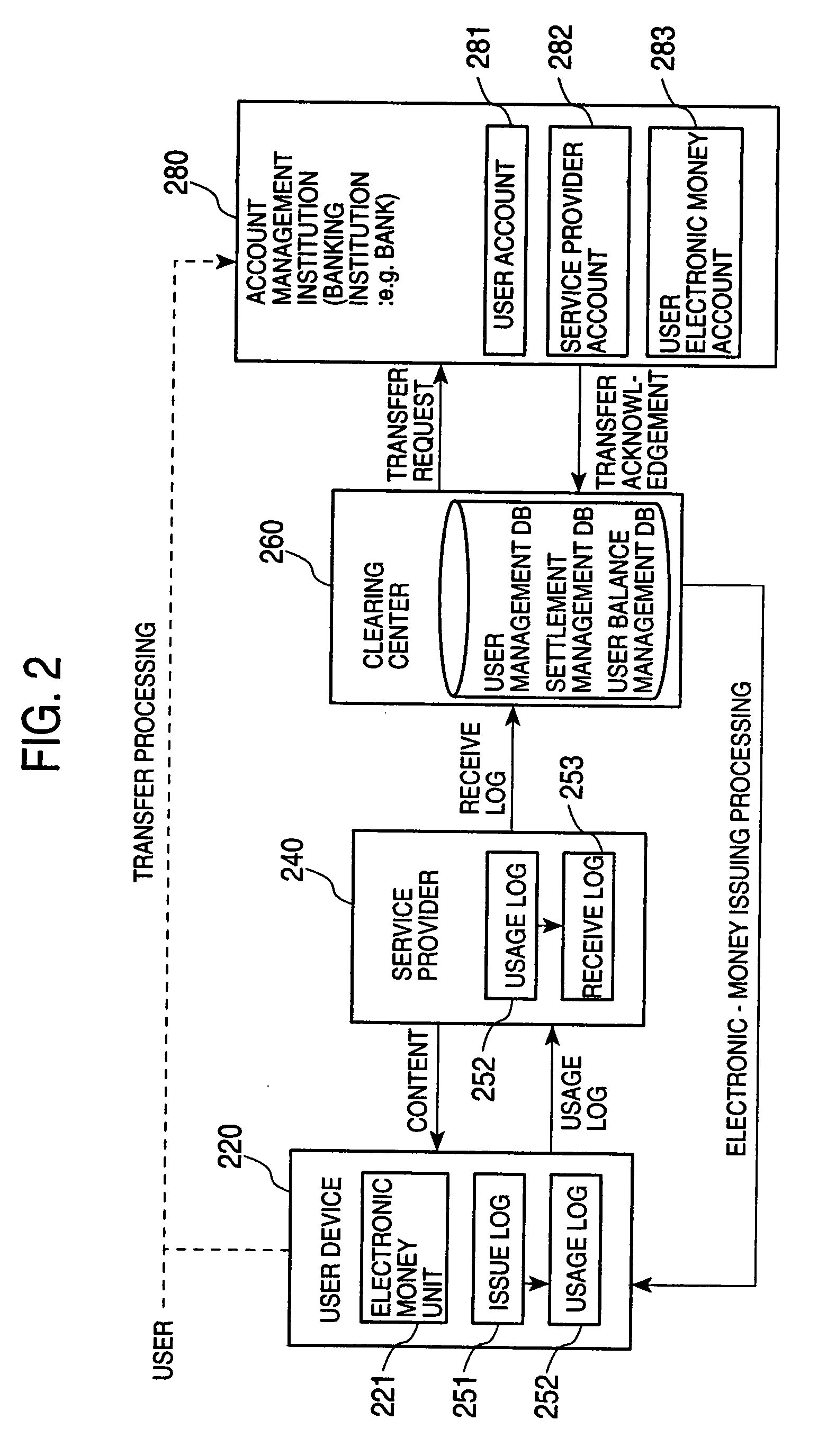

Content transaction system and method, and program providing medium therefor

InactiveUS20070073624A1Key distribution for secure communicationDigital data processing detailsContent IdentifierUser device

A user device receives the content, and pays a content fee, based on the usage control policy of the content, by electronic money up to the allowable amount of money set in an issue log. The user device then creates a usage log including a content identifier and sends it to a service provider. The service provider creates a receive log based on the usage log, and sends it to a clearing center. The clearing center performs settlement processing for the electronic money based on the receive log, and sends a transfer request to an account management institution. By performing the above-described series of processing by using encrypted data, the settlement of the content usage fee is safely performed.

Owner:ISHIBASHI YOSHIHITO +4

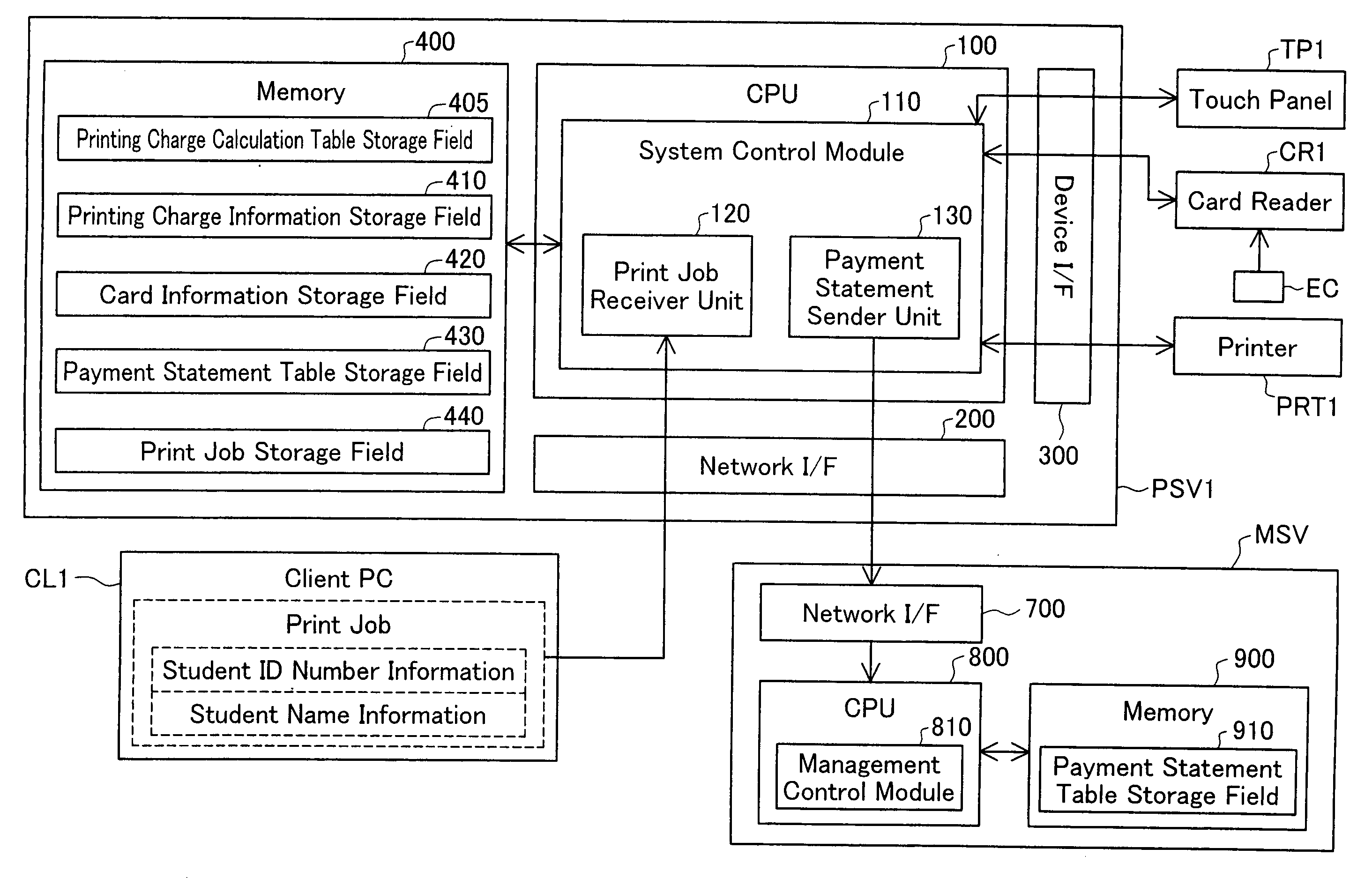

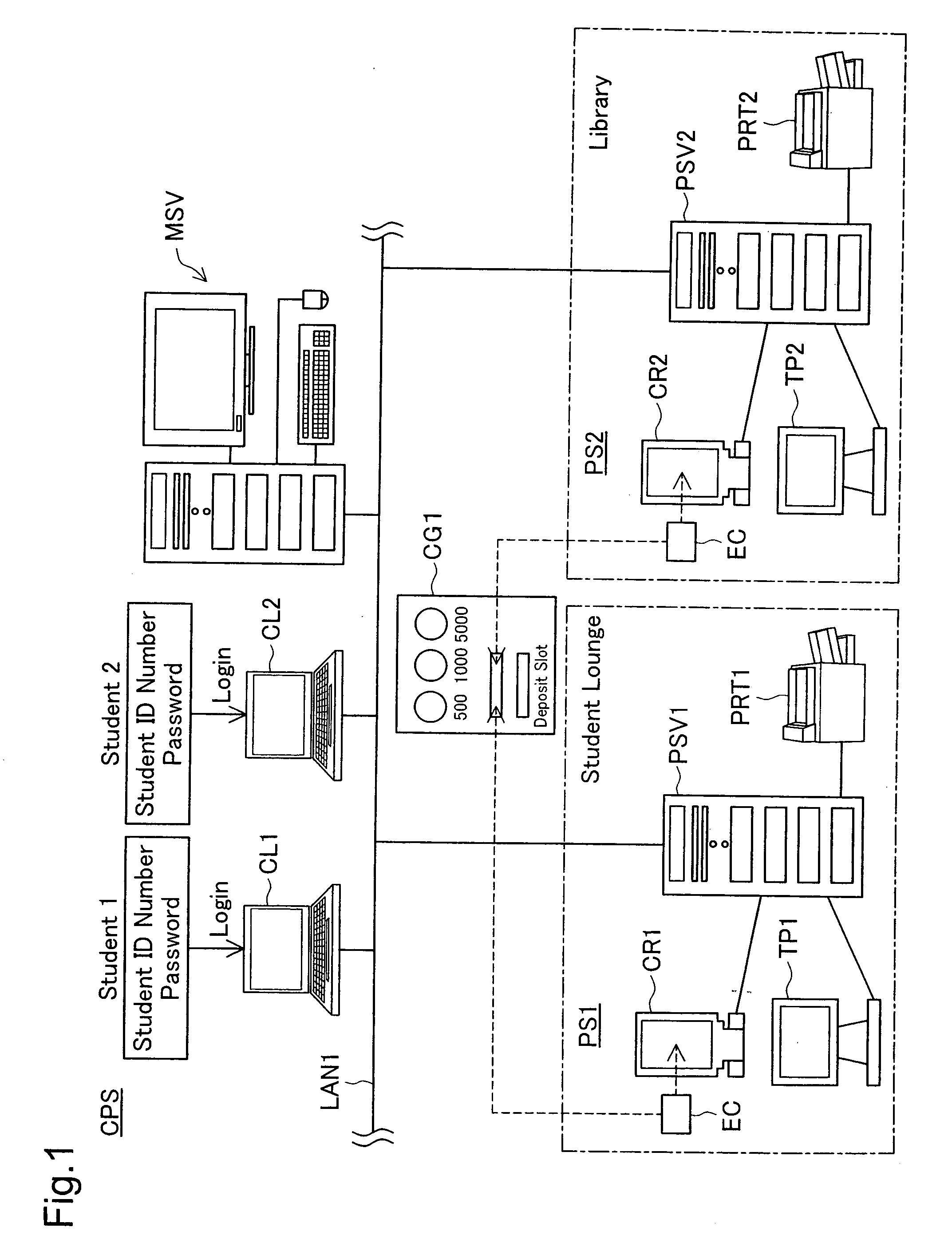

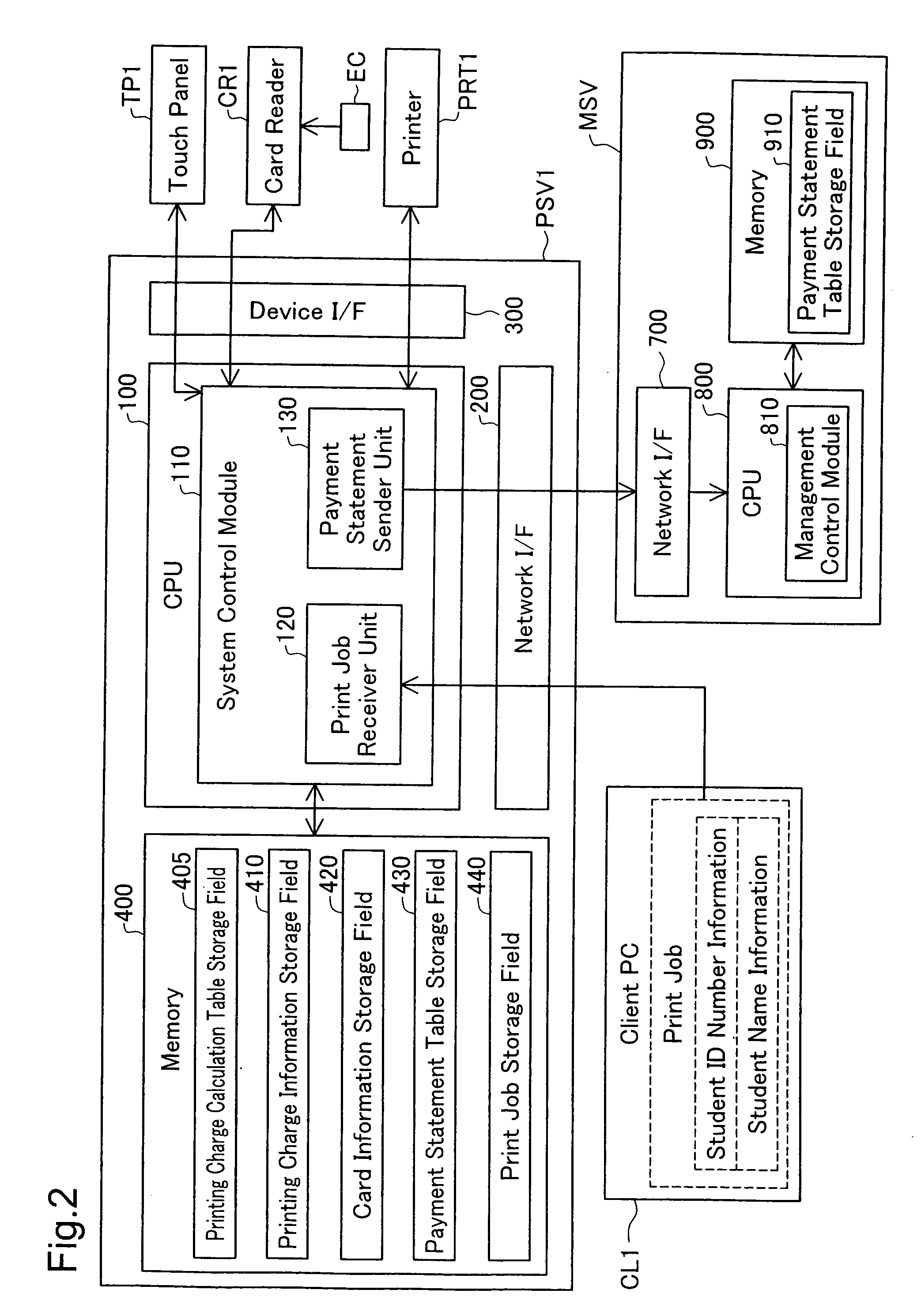

Charge settlement device and charge settlement system

InactiveUS20060065715A1Drawback can be obviatedEffectively restrains the user from goingApparatus for meter-controlled dispensingBilling/invoicingPaymentComputer science

The charge settlement device of the invention has an information reading unit. When a certain fee is charged to a user and the user places a contactless storage medium, which stores electronic money information and user identification information for identification of the user, close to the information reading unit, the charge settlement device subtracts an amount corresponding to the certain fee from available electronic money represented by the electronic money information for payment of the certain fee. When the user places the contactless storage medium close to the information reading unit, the user is identified based on the user identification information obtained from the contactless storage medium. In response to detection of the certain fee charged to the identified user, indication of the user identification information and a payment request, which asks the user to place the contactless storage medium close to the information reading unit for payment, is kept until the user actually places the contactless storage medium close to the information reading unit. The technique of the invention effectively restrains the user from going away without the required payment.

Owner:SEIKO EPSON CORP

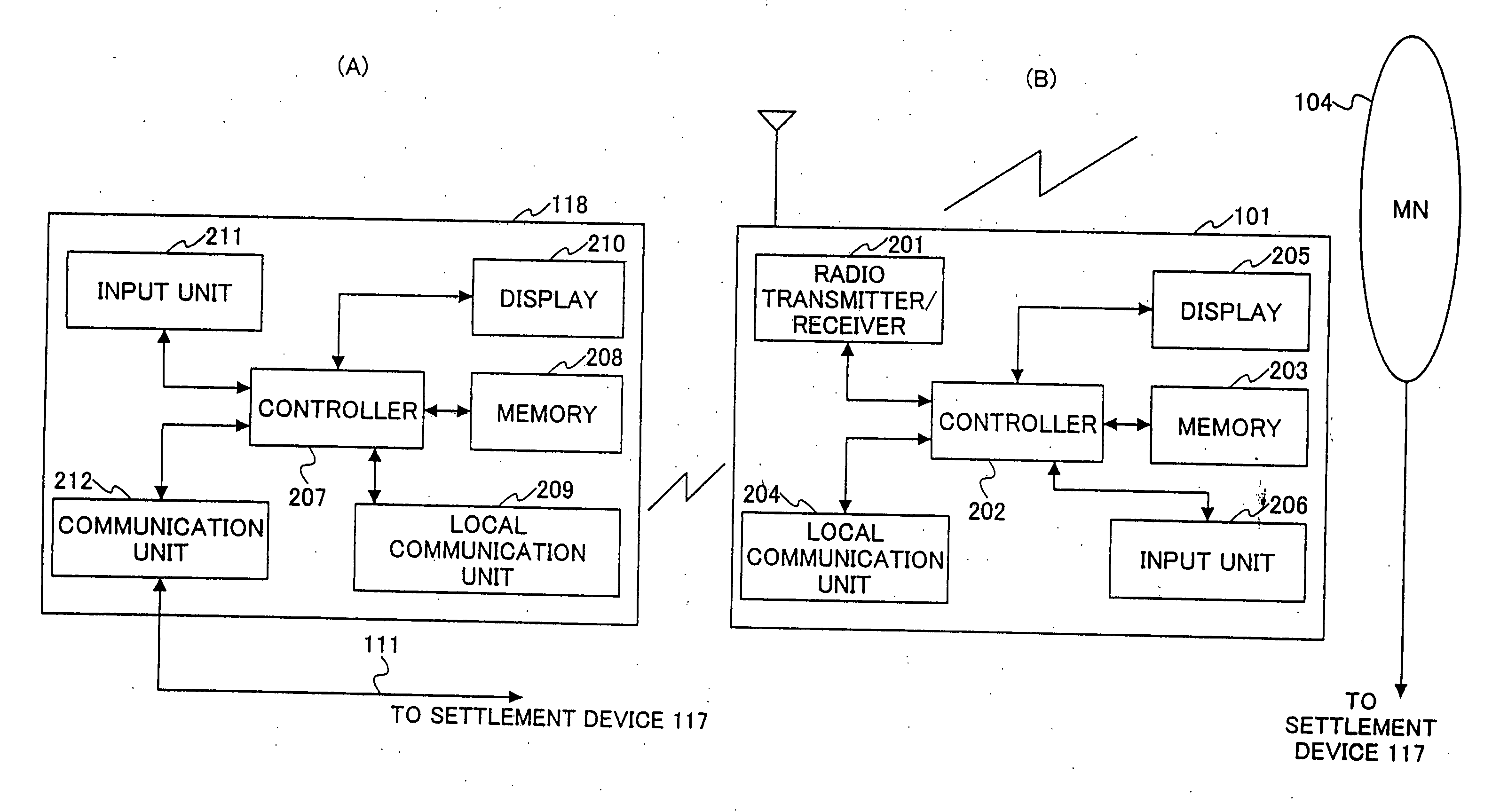

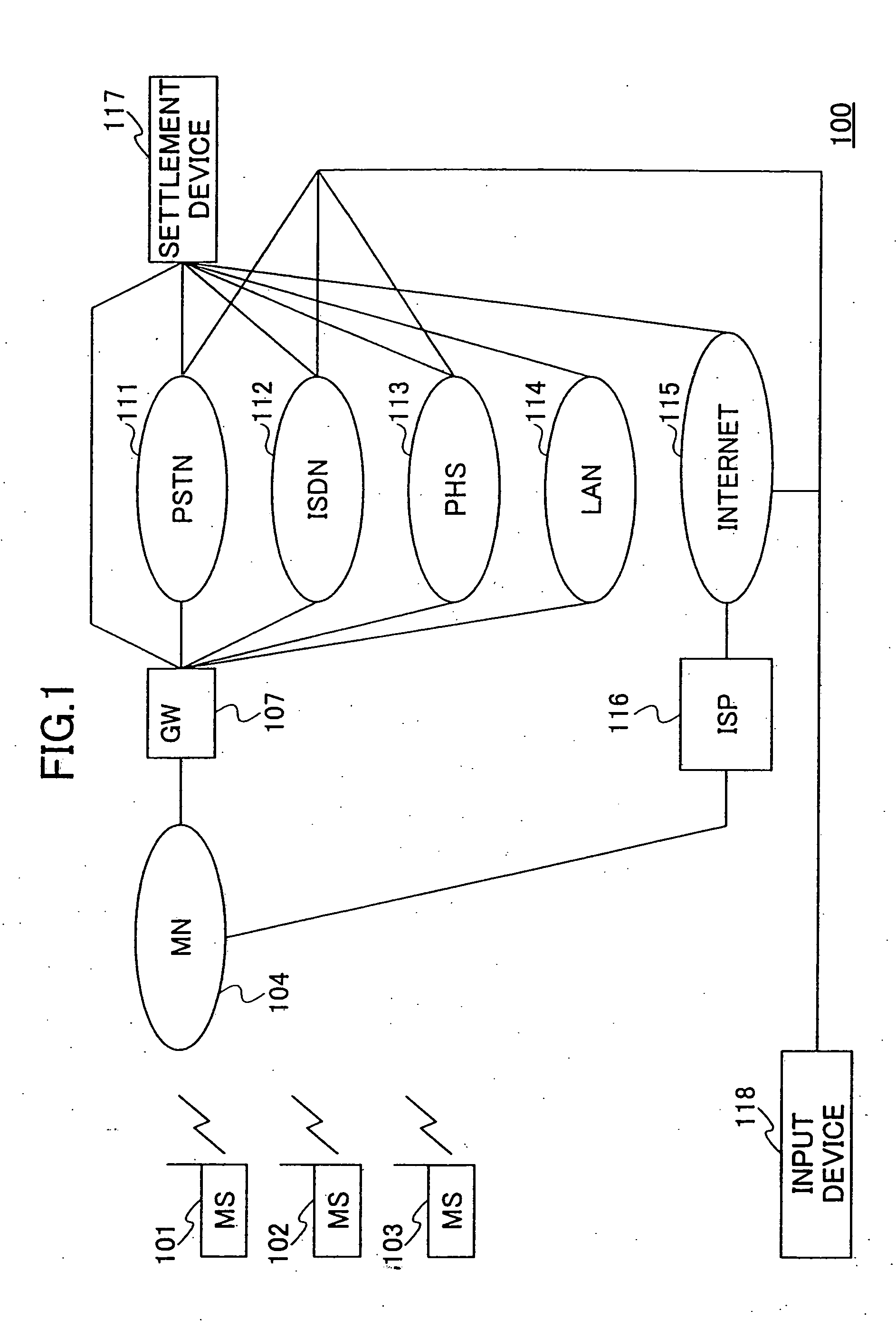

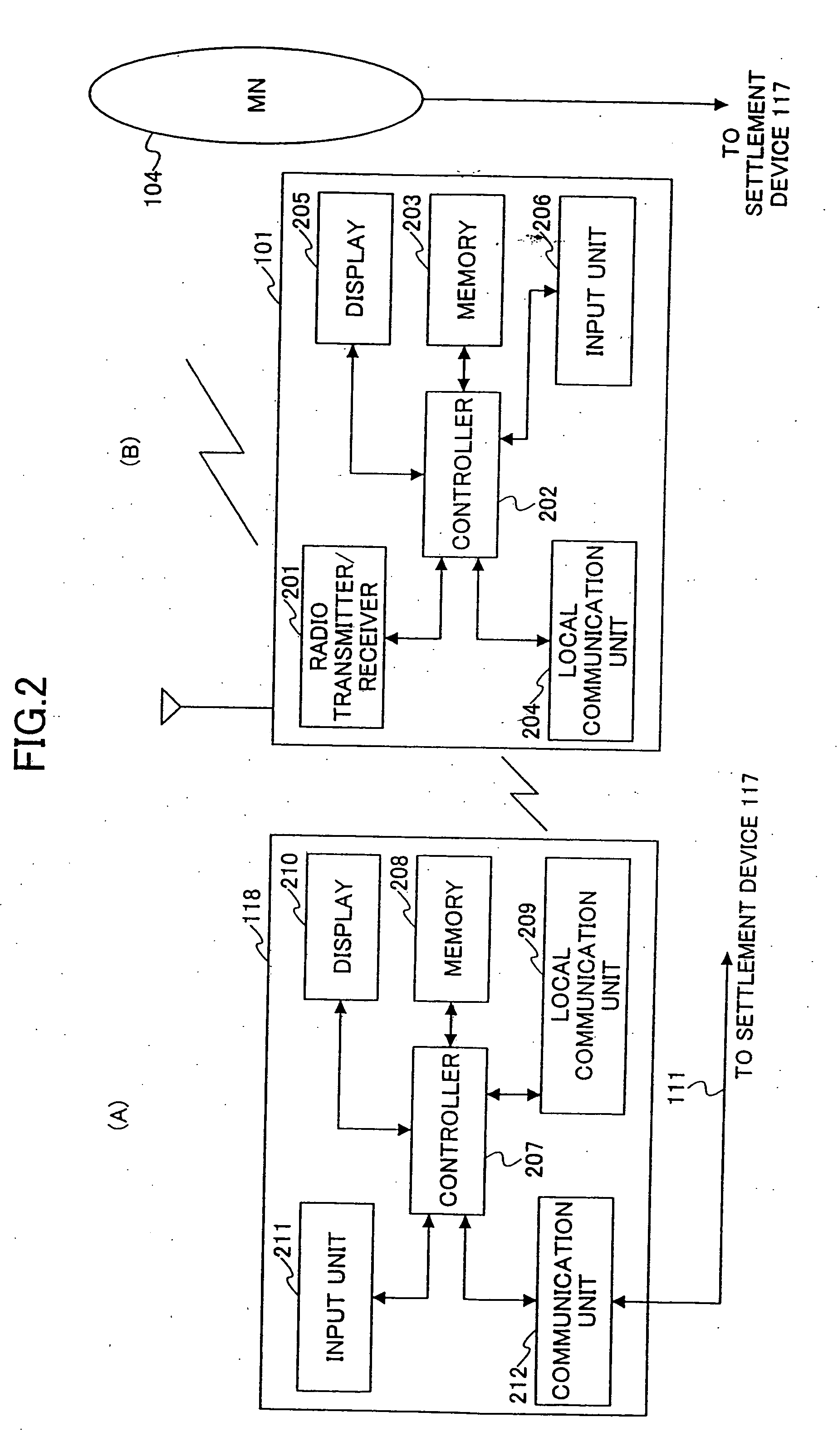

Mobile communication terminal and method for electronic money settlement

InactiveUS20090327089A1Charging safetyHand manipulated computer devicesFinanceDisplay deviceComputer terminal

There is provided a settlement system comprising a mobile communication terminal, a settlement input device configured to output data of a charge, and a settlement device able to transfer money from a first account to a second account. The settlement input device comprises a first transmission unit configured to transmit the data of the charge to the mobile communication terminal, and a second transmission unit configured to transmit the data of the charge, identification data of the mobile communication terminal, and identification data of the settlement input device to the settlement device. The settlement device comprises a control unit configured to transfer an amount of money determined by the data of the charge from the first account to the second account, and a transmission unit configured to transmit the data of the amount of the transferred money to the mobile communication terminal. The mobile communication terminal comprises a first reception unit configured to receive the data of the charge from the settlement input device, a second reception unit configured to receive the data of the amount of the transferred money from the settlement device, and a display.

Owner:FUJITSU LTD

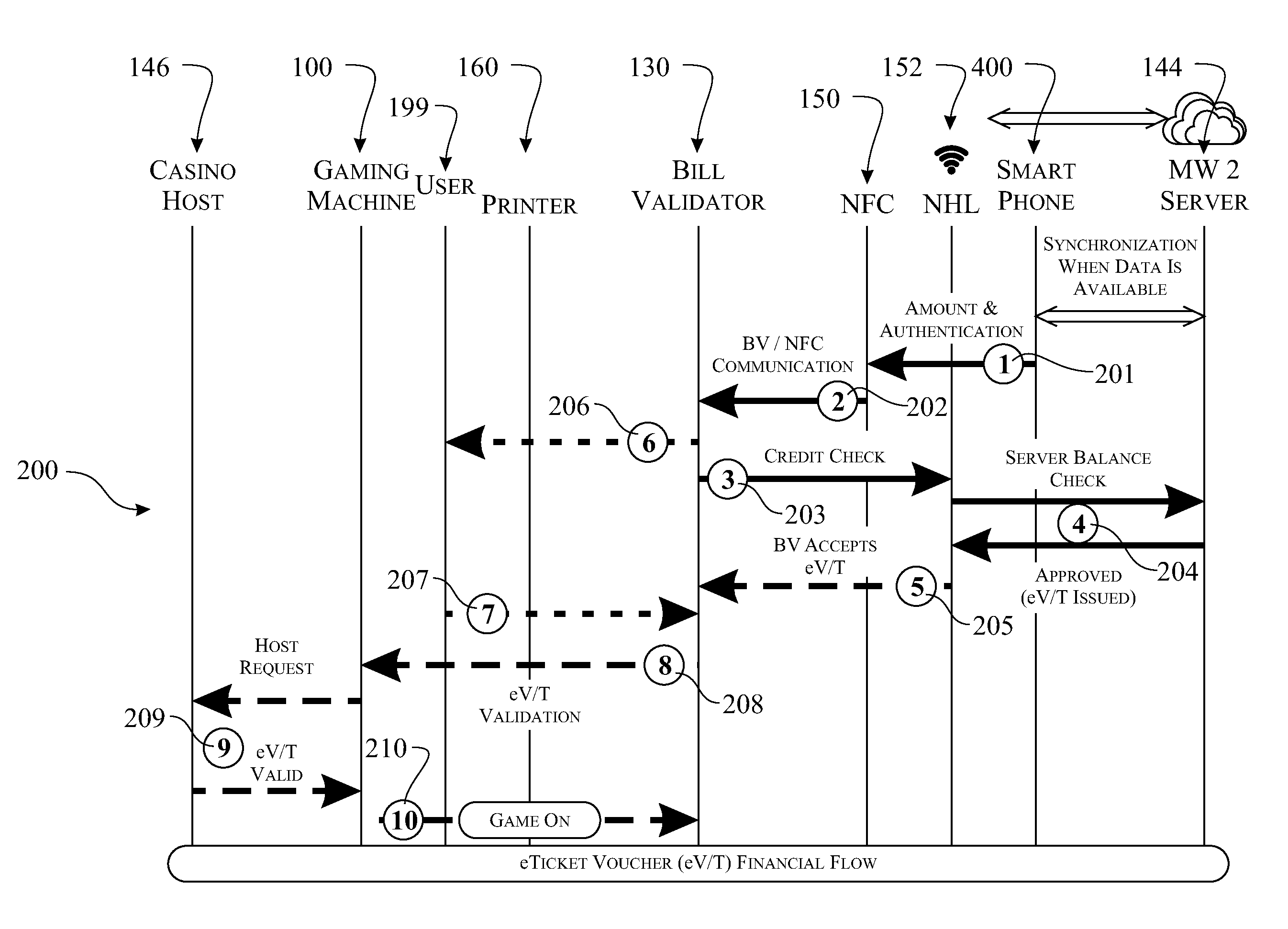

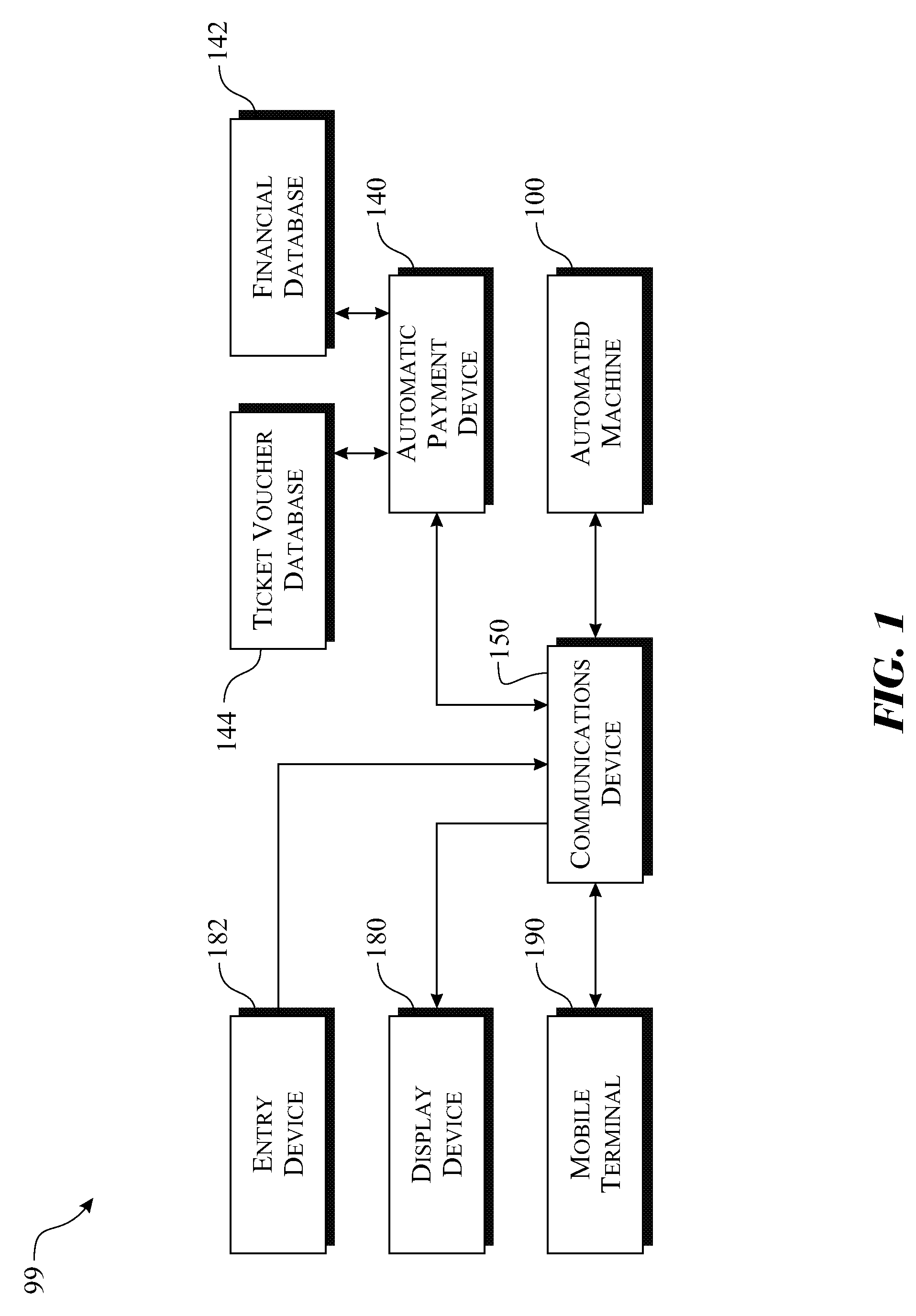

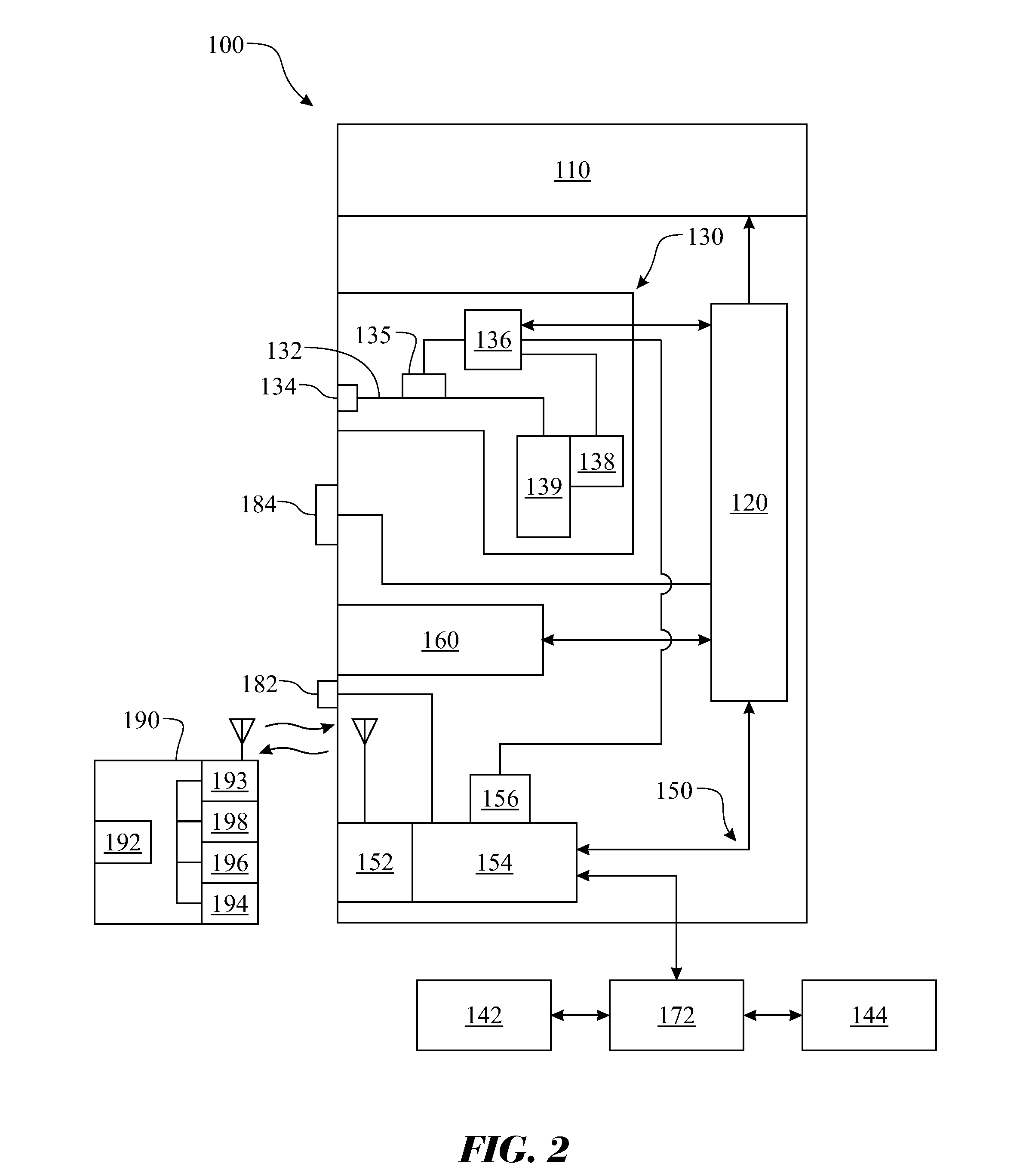

Electronic Voucher Ticket System

ActiveUS20160086145A1Increase and decrease valueAdvertisementsApparatus for meter-controlled dispensingVoucherFinancial transaction

A voucher ticket system and method of use employing a bill validator installed into any suitable automated machine, including an Automated Teller Machine (ATM), a gaming machine, etc. The bill validator is integrated with a bill reader, a voucher ticket reader, a reader for acquisition of electronic voucher ticket information from a portable computing device, a printer, and other supporting peripheral devices. The voucher ticket system includes a secured communication link with a host account manager serving a plurality of electronic money accounts. The method includes steps of receiving a value of electronic money or identification information associated with the electronic voucher ticket with account information associated with the electronic money account and sending the received value of the electronic money or the identification information of the voucher ticket to an upper control section of the one of the gaming machine and the ATM for completion of a financial transaction.

Owner:JCM AMERICAN CORP

System And Method For Performing A Purchase Transaction With A Mobile Electronic Device

InactiveUS20150302374A1Shorten the timeDebit schemesPayment circuitsElectronic systemsFinancial transaction

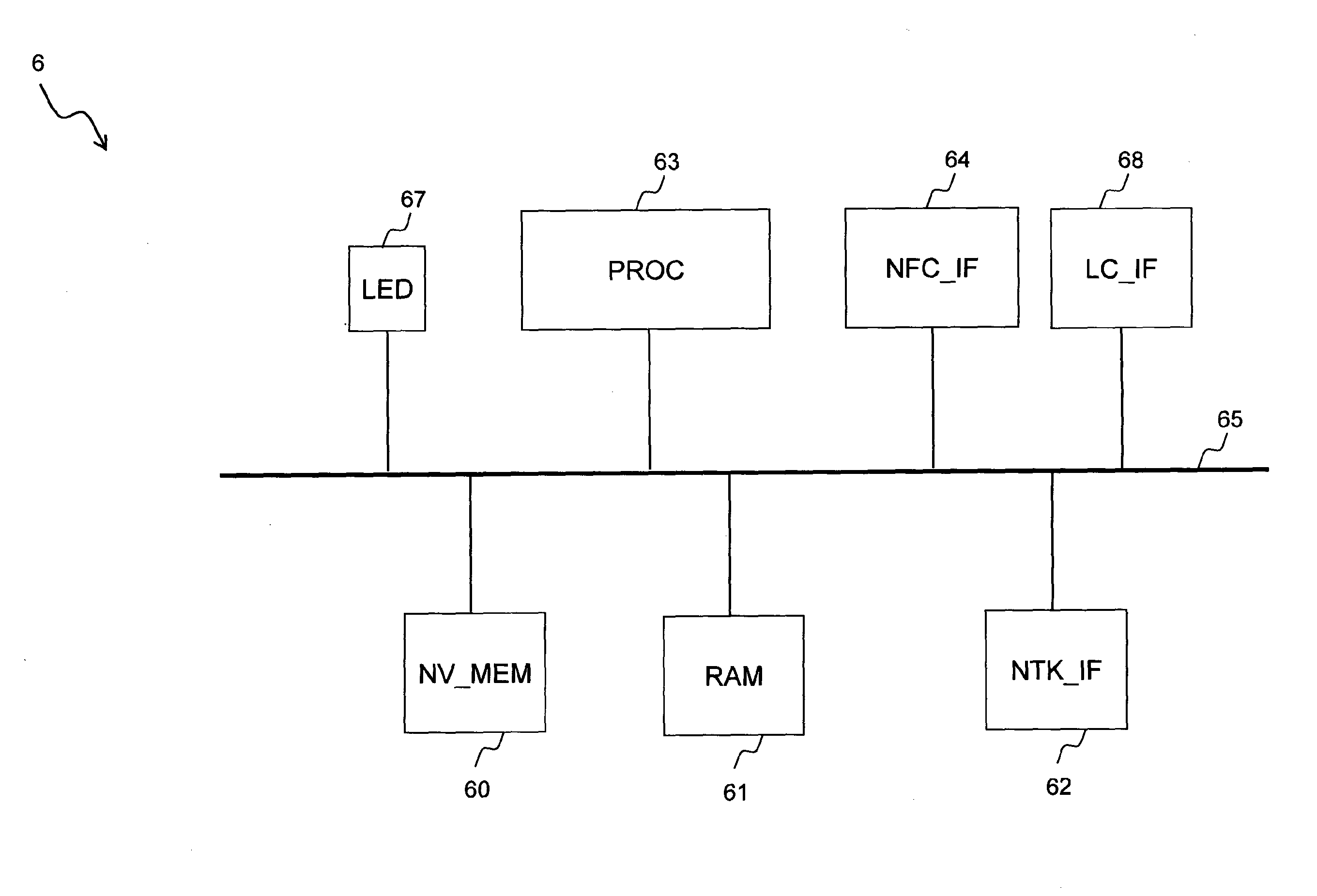

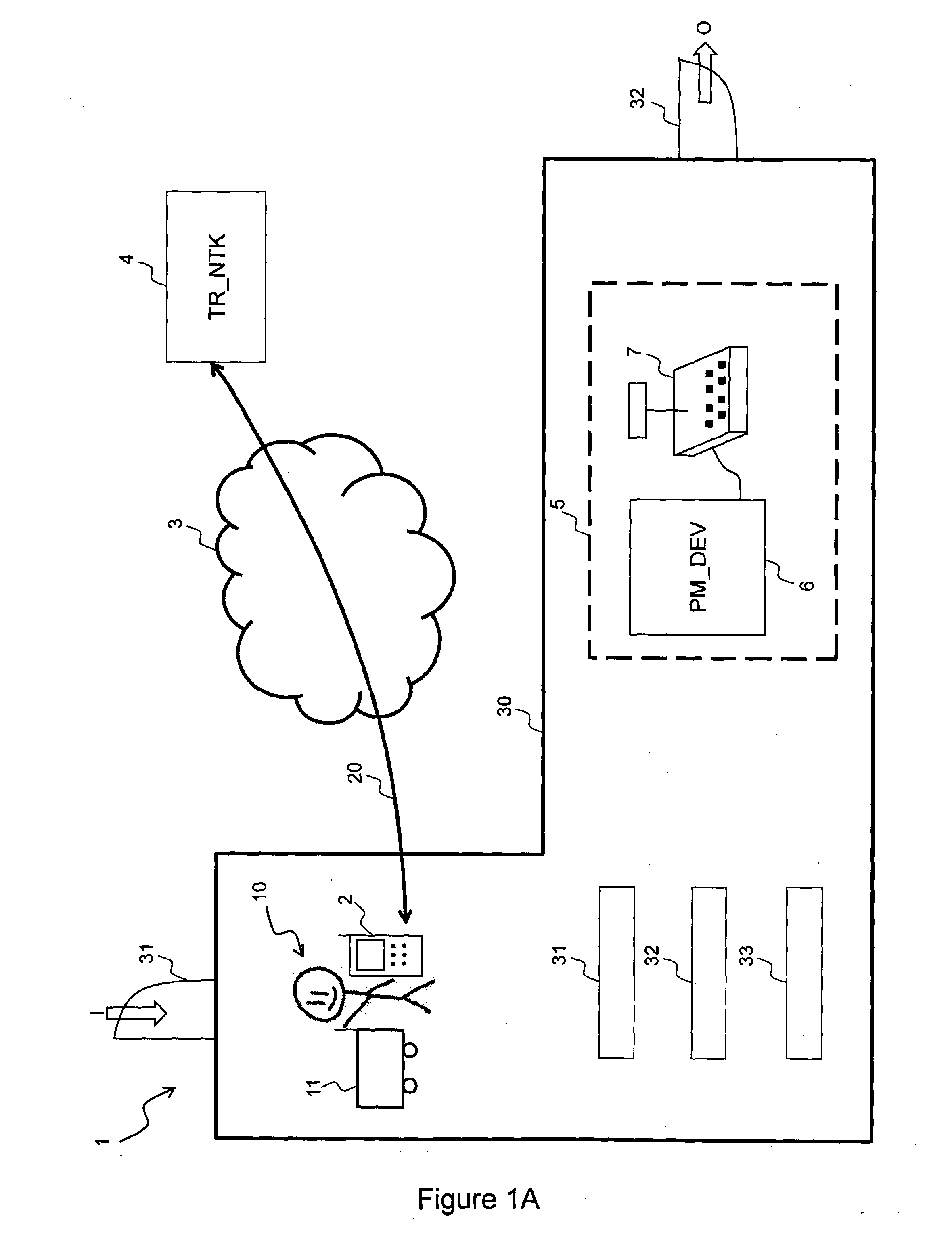

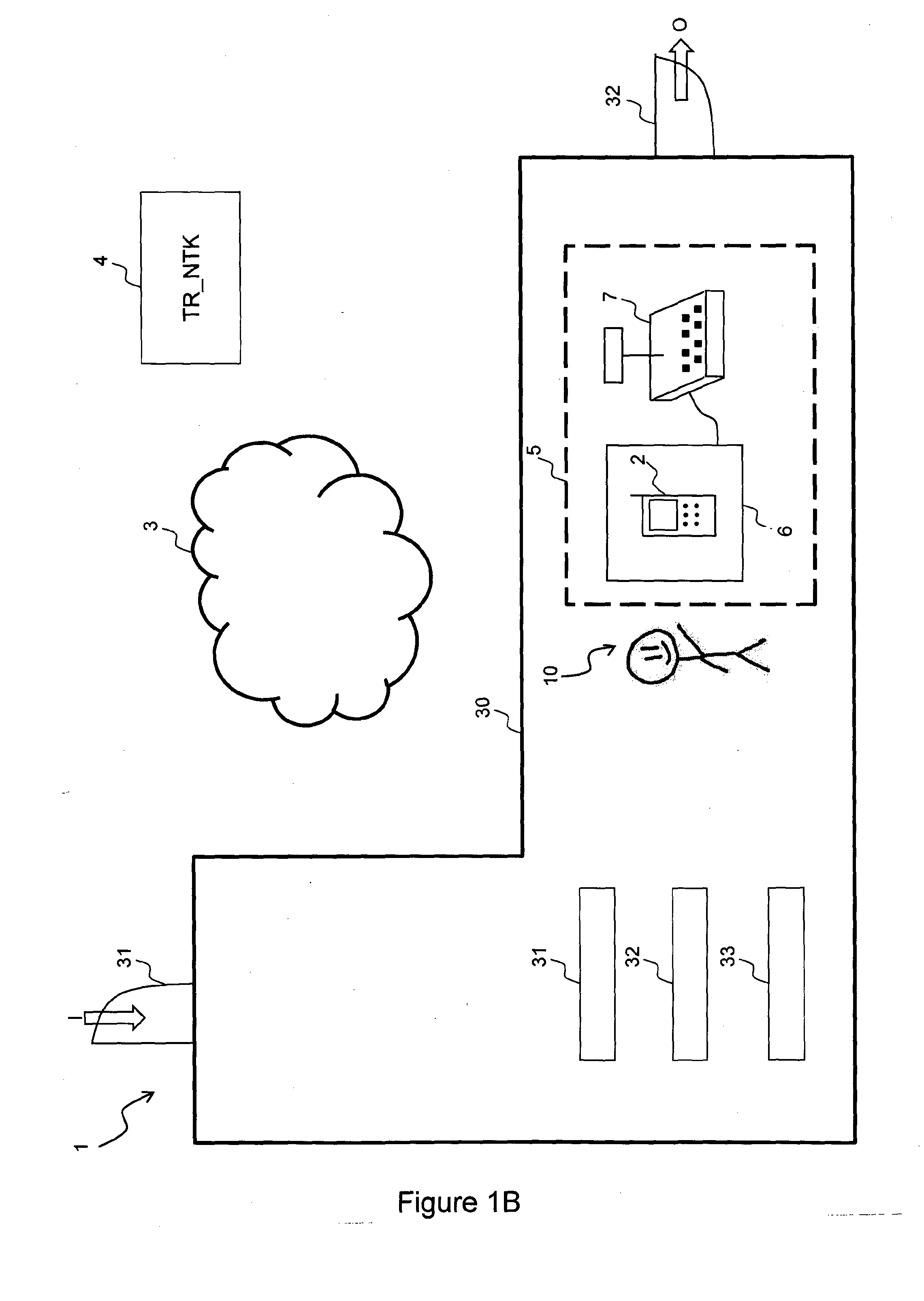

An electronic system (1) is described to perform a purchase transaction of goods or services. The system includes a mobile electronic device (2) configured to receive (t3) a second message (MSG2) carrying an authorization data field (AUT_D) dicating a valid or invalid authorization to use an electronic money for performing the purchase transaction, configured to store the content of the authorization data field into a non-volatile memory (160) inside the mobile electronic device and configured to transmit (t5; t7′) a third message (MSG3; MSG4′) carrying an electronic money identification data field (EM_ID) for indicating data identifying the electronic money used for performing the purchase transaction and carrying the authorization data field (AUT_D; AUT_D′). The system further includes a transaction server (4) configured to transmit (t2) the second message (MSG2) carrying the authorization data field (AUT_D) and configured to receive (t10) a fifth message (MSG5) carrying the electronic money identification data field (EM_ID) and carrying a bill amount field (BL_AM) indicating a bill amount to be paid for the selected goods or services and transmit (t11) therefrom a sixth message (MSG6) carrying a settlement result field (RES_STL) for indicating if the value of the bill amount has been debited on the electronic money. The system further includes a Point-of-Sale device (6) configured to receive (t6; t8′) from the mobile electronic device the third message (MSG3; MSG4′) carrying the electronic money identification data field (EM_ID) and the authorization data field (AUT_D; AUT_D′) and transmit (t9) therefrom the fifth message (MSG5) carrying the electronic money identification data field and the bill amount field (BL_AM), in case of a valid value of the content of the authorization data field.

Owner:SARTOR ANDREA

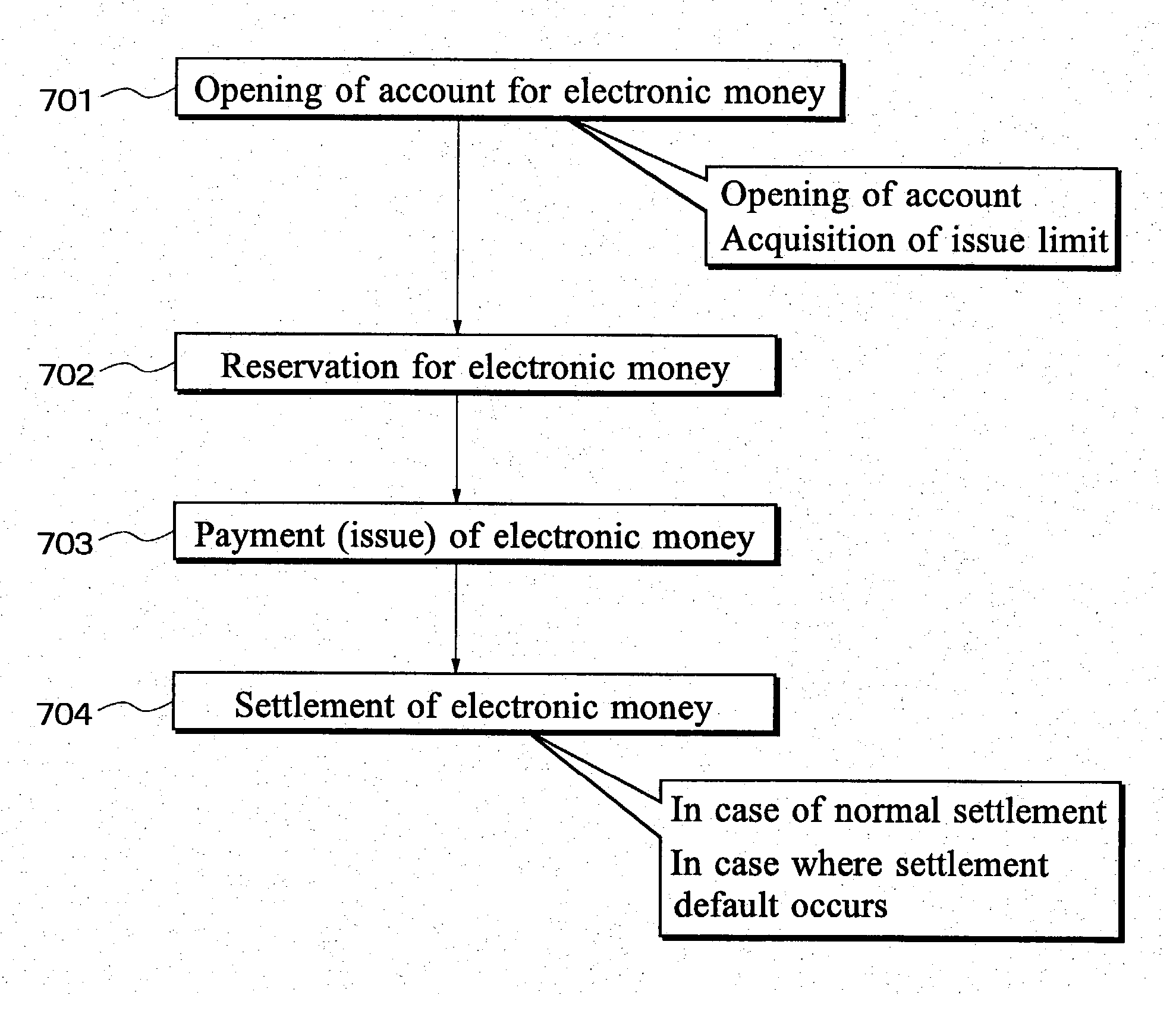

Electronic money issuing system

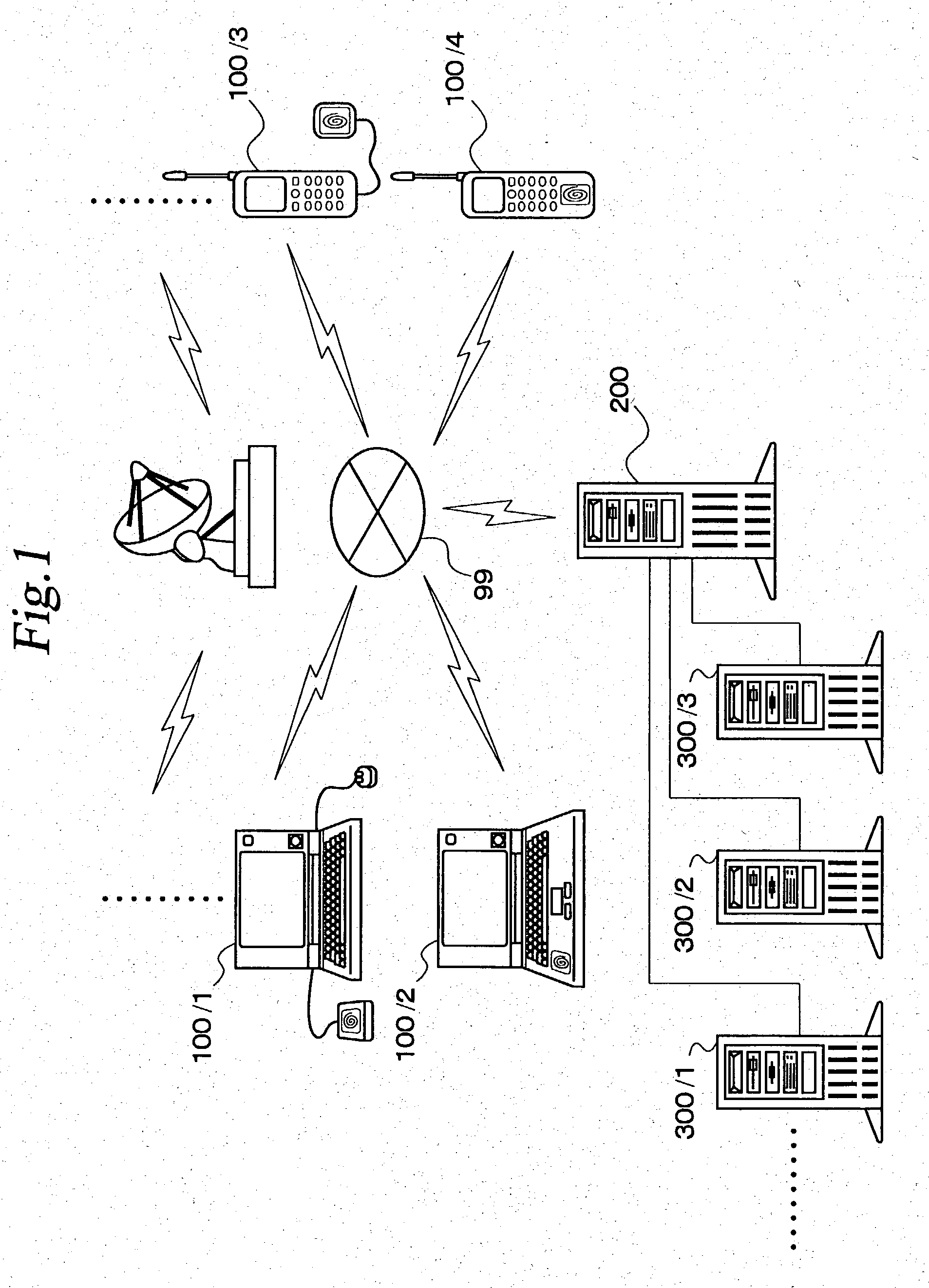

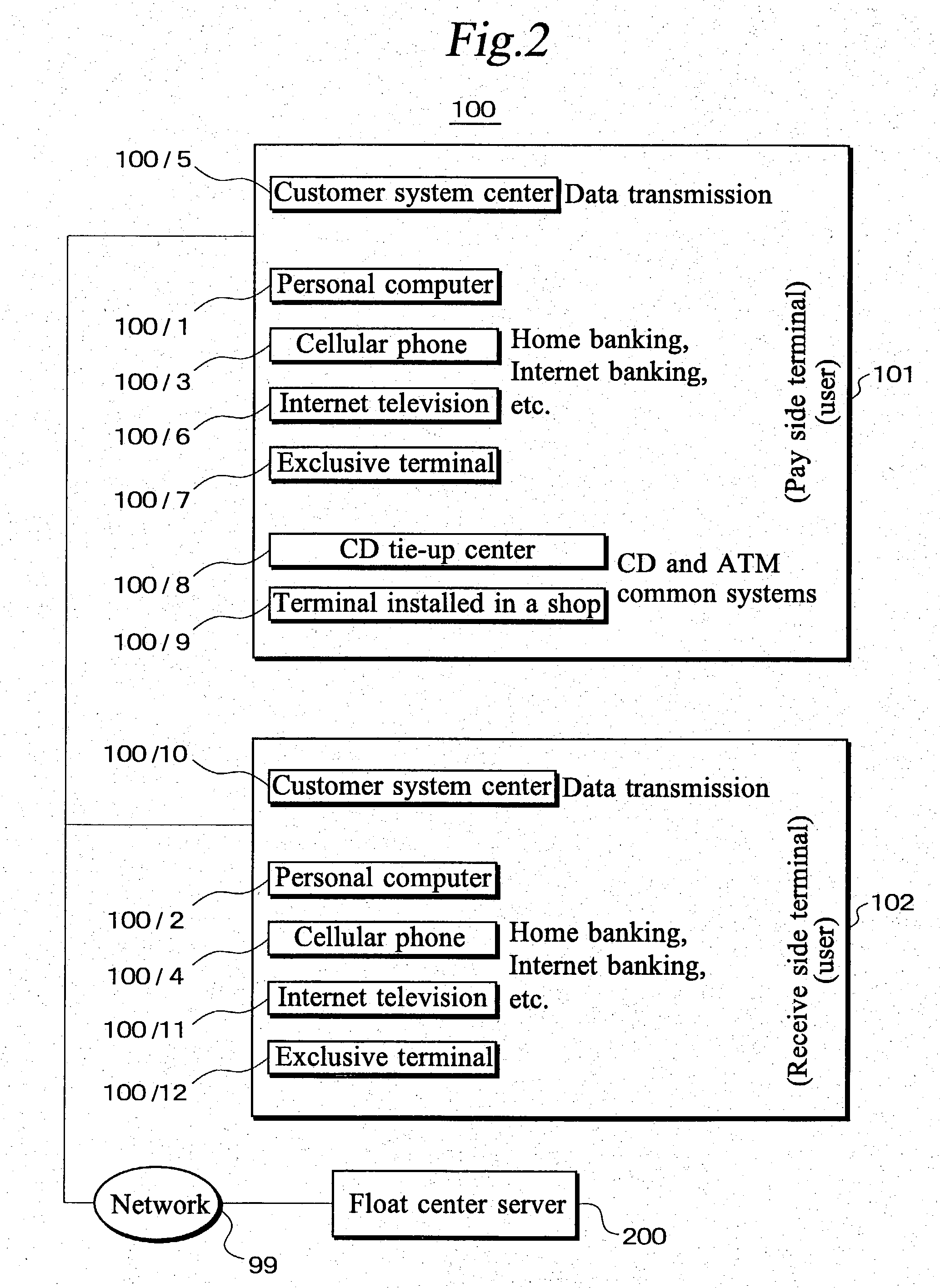

An electronic money issuing system of low risk. A float center server (200) manages information on electronic money issued to a user and information on the capital (e.g. bank deposit and real estate) of the user and on credit limit backing the issuance of electronic money. Electronic money is issued for payment. When the receiver transmits the amount and

Owner:OHMAE KENICHI

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com