Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

212 results about "Cash payment" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Cash payment. A form of liquid funds given by a consumer to a provider of goods or services as compensation for receiving those products. In most domestic business transactions, a cash payment will typically be made in the currency of the country where the transaction takes place, either in paper currency, in coins or in an appropriate combination.

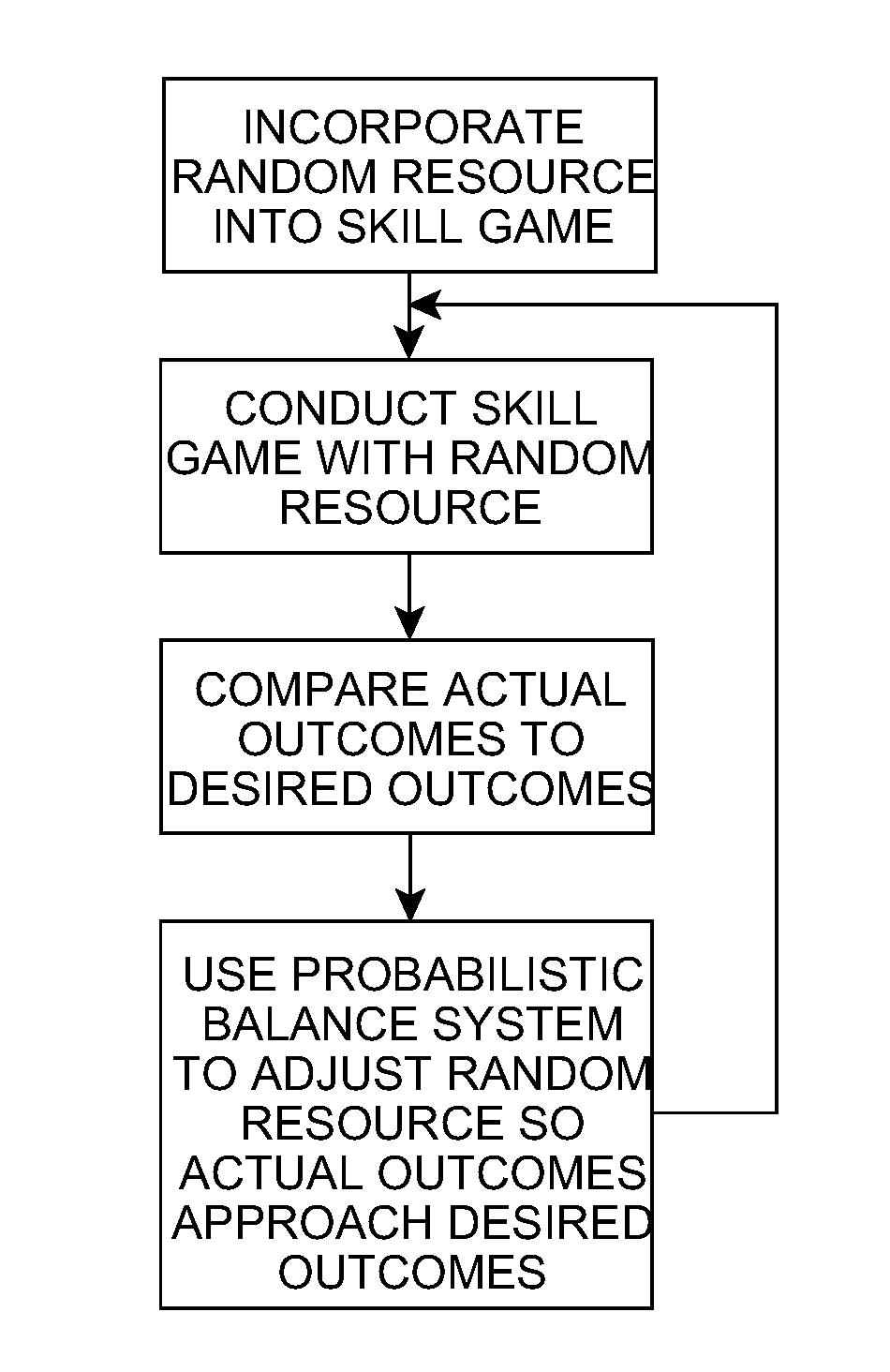

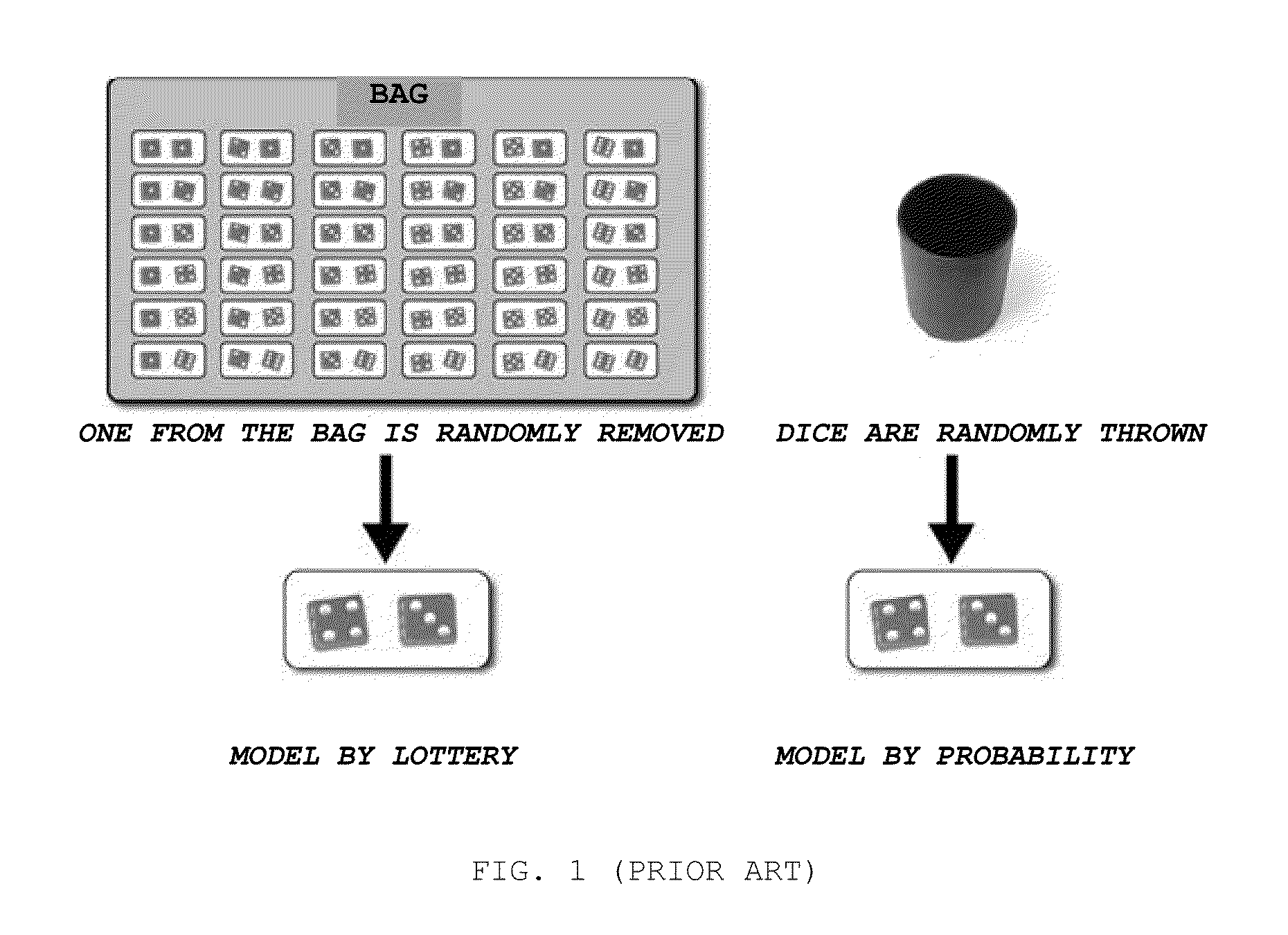

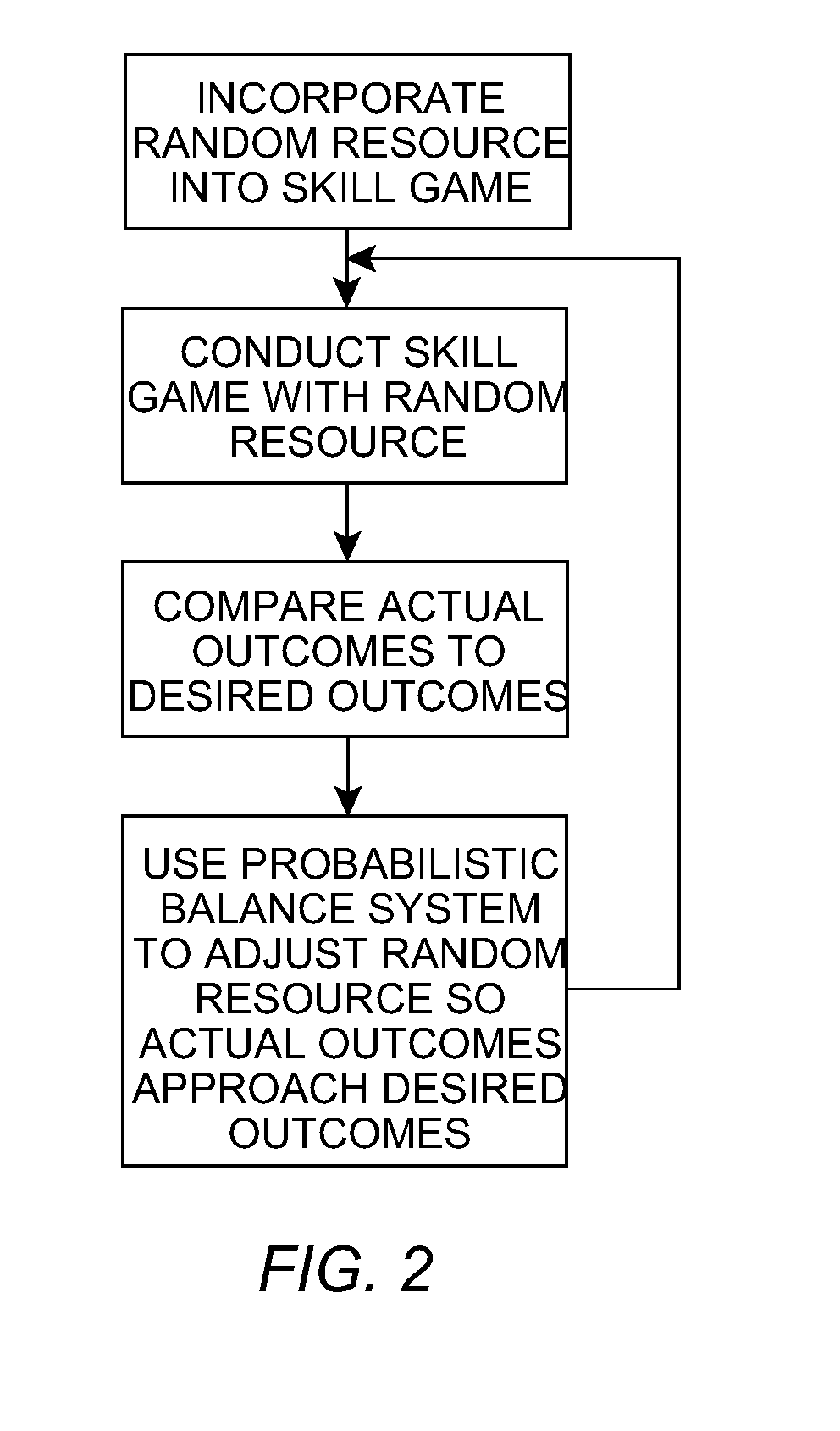

System for Incorporating Chance Into Interactive Games Requiring the Application of Intellectual or Motor Skills

InactiveUS20110009178A1Apparatus for meter-controlled dispensingVideo gamesMaximum levelSystems management

The invention refers to digital interactive games operable from specific terminals, video game consoles, personal computers, cell phones, digital interactive television, even when they include an initial bit of chance for their usual development, in order to incorporate the possibility to get a prize (including cash payments), besides of simply diversion. It comprises the incorporation of at least one random resource capable of sustaining a mathematical balance between winners and losers equivalent to that governing games of pure chance, keeping the condition that, for the resolution of each game, it requires the participation of the person, his / her with and his / her visual, motor, spatial, and linguistic skills, besides to his / her knowledge. The incorporated random resource is managed by a probabilistic balance system that ensures the proper ratio between winners and losers in terms of the predetermined “payout”. The incorporated random resource could be either a lottery of maximum results including the previous draw of the maximum result the player can reach (although he / she plays it perfectly), or a lottery of levels of difficulty that draws the level of difficulty set for each game between a maximum level (virtually impossible to overcome) and a minimum level (very easy to overcome), or a combination of both of them.

Owner:IPARK ENTRETENIMENTOS S L U

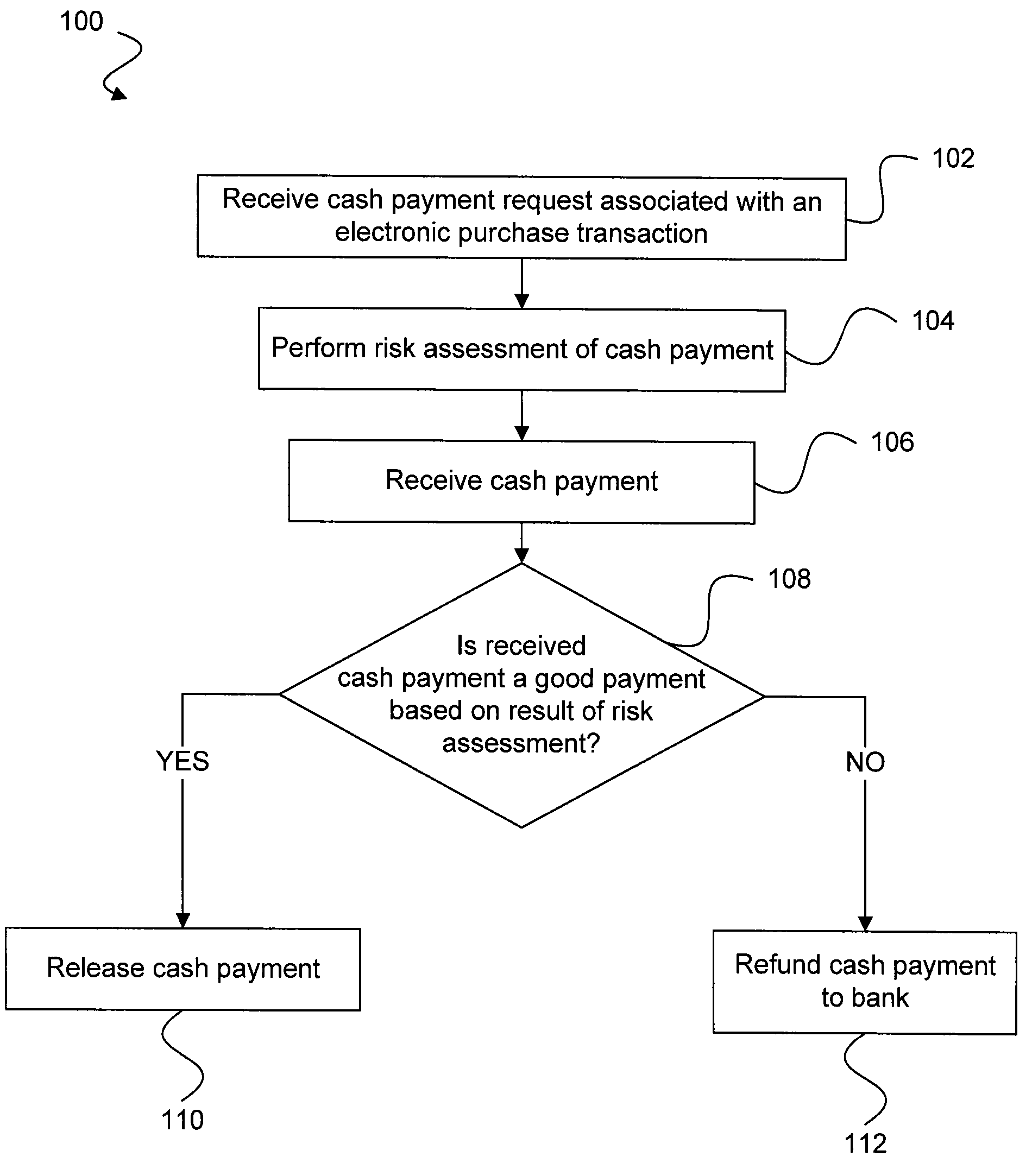

Risk detection and assessment of cash payment for electronic purchase transactions

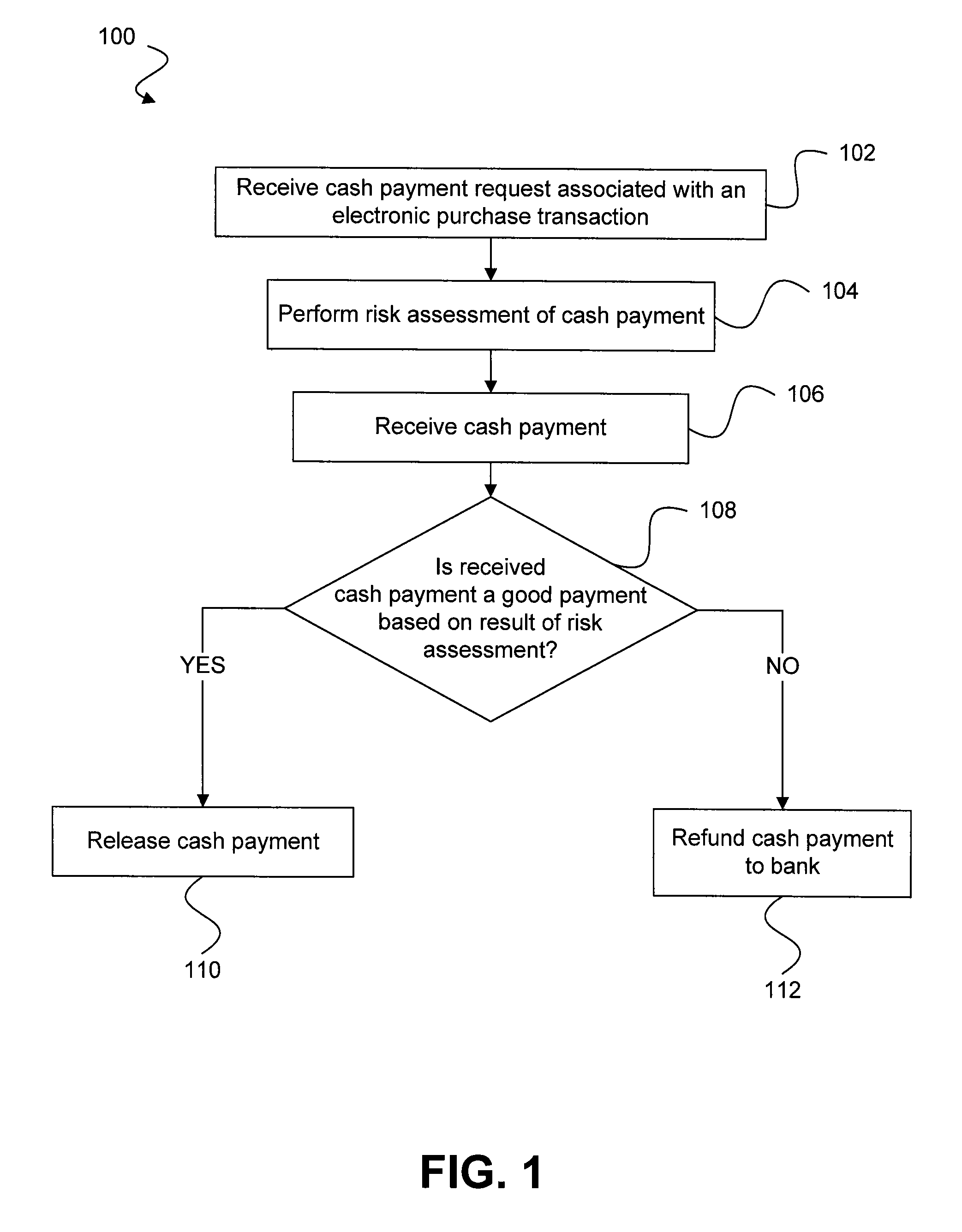

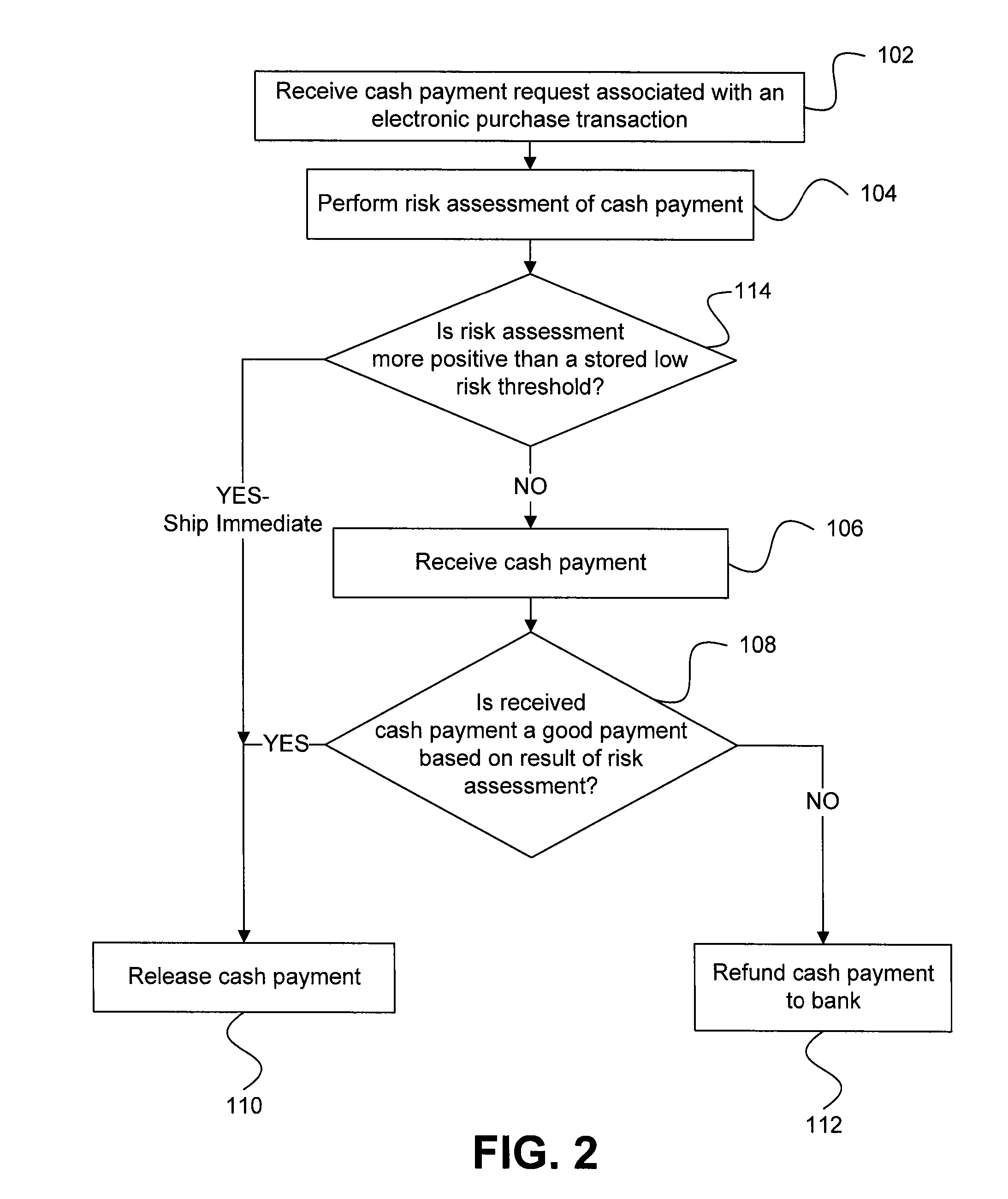

A system and methods are provided which allow consumers to pay for ecommerce transactions through online bill payment and for merchants to determine that payments are not fraudulent. The system and methods do not rely on personal or confidential customer information relating to credit-cards and / or bank account routing information, date of birth and / or social security number. A risk manager can perform risk assessment for the cash payment based on order information and non-confidential purchaser information included in a cash payment request. In response to receiving an indication of the cash payment from the purchaser, a determination is made whether the cash payment is a good payment based on the risk assessment. The cash payment is released to a merchant in response to a determination that the cash payment is a good payment.

Owner:WESTERN UNION FINANCIAL SERVICES

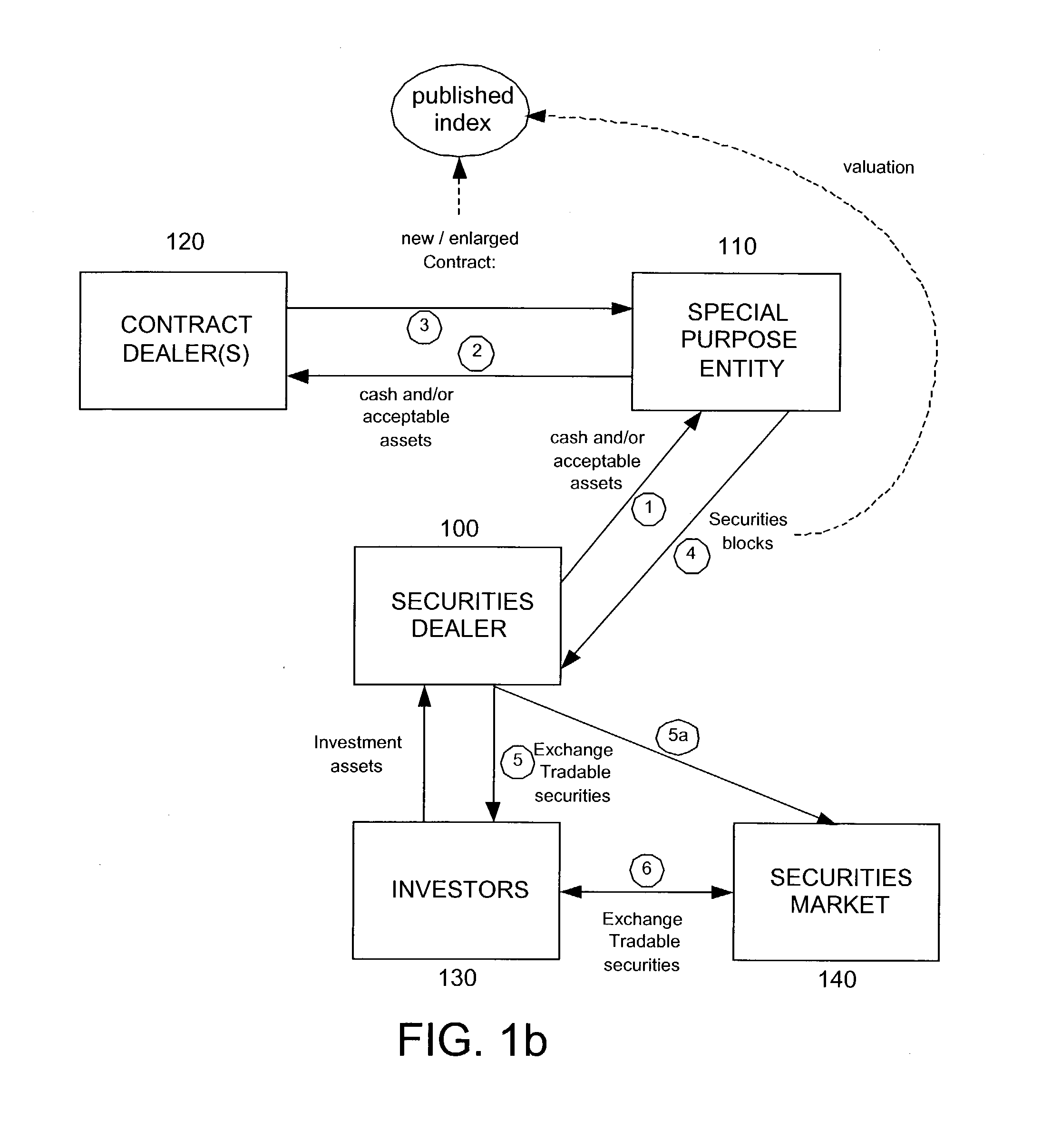

Method and system for securitizing contracts valued on an index

InactiveUS20050119962A1Minimized fund level taxationRisk minimizationFinanceSpecial data processing applicationsOperating systemOn demand

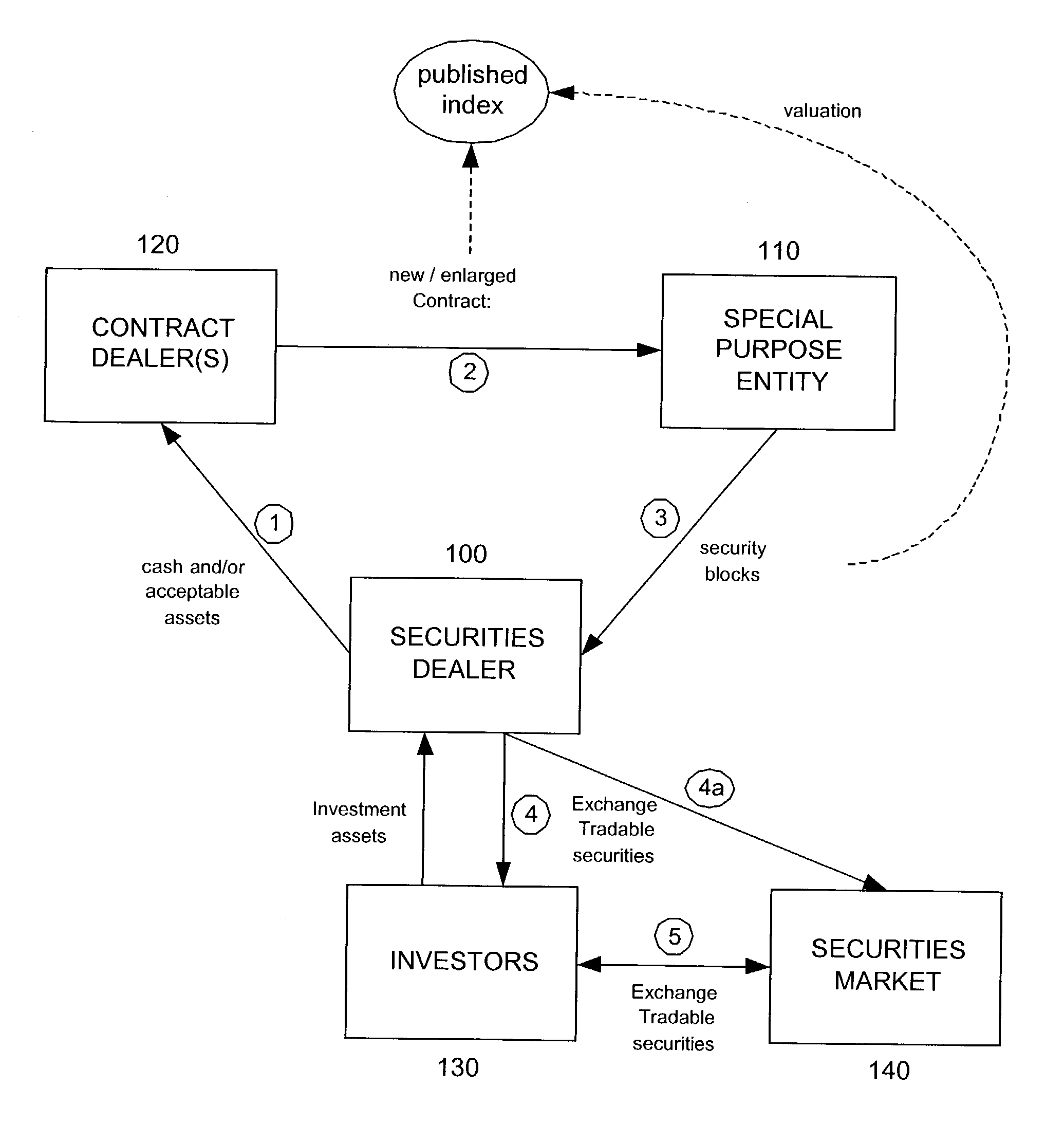

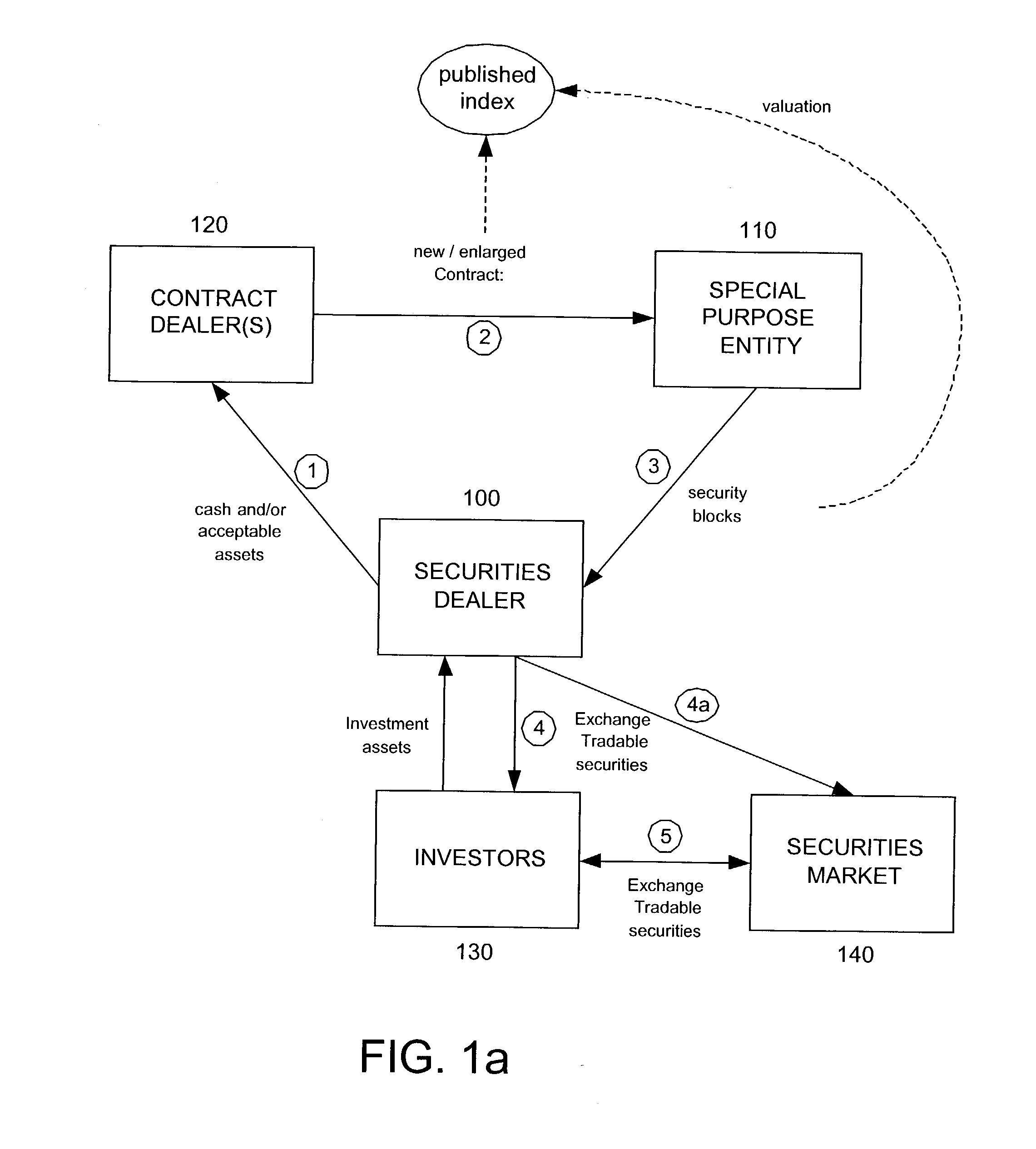

In a method and system for securitizing contracts valued on an index, a special purpose entity (SPE) is provided and holds as substantially all of its assets a derivative contract with a contract dealer. The contract has an initial notional value and is tied to an index related to items traded by a multilateral transactional execution facility, such as futures contracts traded on an exchange. The held contract is also scalable so that the notional value can be increased on demand in exchange for a corresponding payment to the contract dealer and decreased on demand in exchange for a corresponding payment from the contract dealer. The SPE issues exchange tradable securities that derive value based on the value of the contract held by the SPE. To issue additional shares, assets are contributed to the contract dealer who increases the notional value of the contract held by the SPE. The increase in value of the contract supports the issuance of additional shares. Shares are redeemed by terminating some or all of the contract whereby the contract dealer reduces the notional value and provides a termination payment based on the amount of the termination and the value of the index. In one embodiment, investors purchase shares by providing to the contract dealer both a cash payment and a futures contract, the combination having a value corresponding to the value of the shares to be issued, and where the futures contract can then be used by the contract dealer to hedge the forward contract between the contract dealer and the SPE.

Owner:NEW YORK MERCANTILE EXCHANGE +1

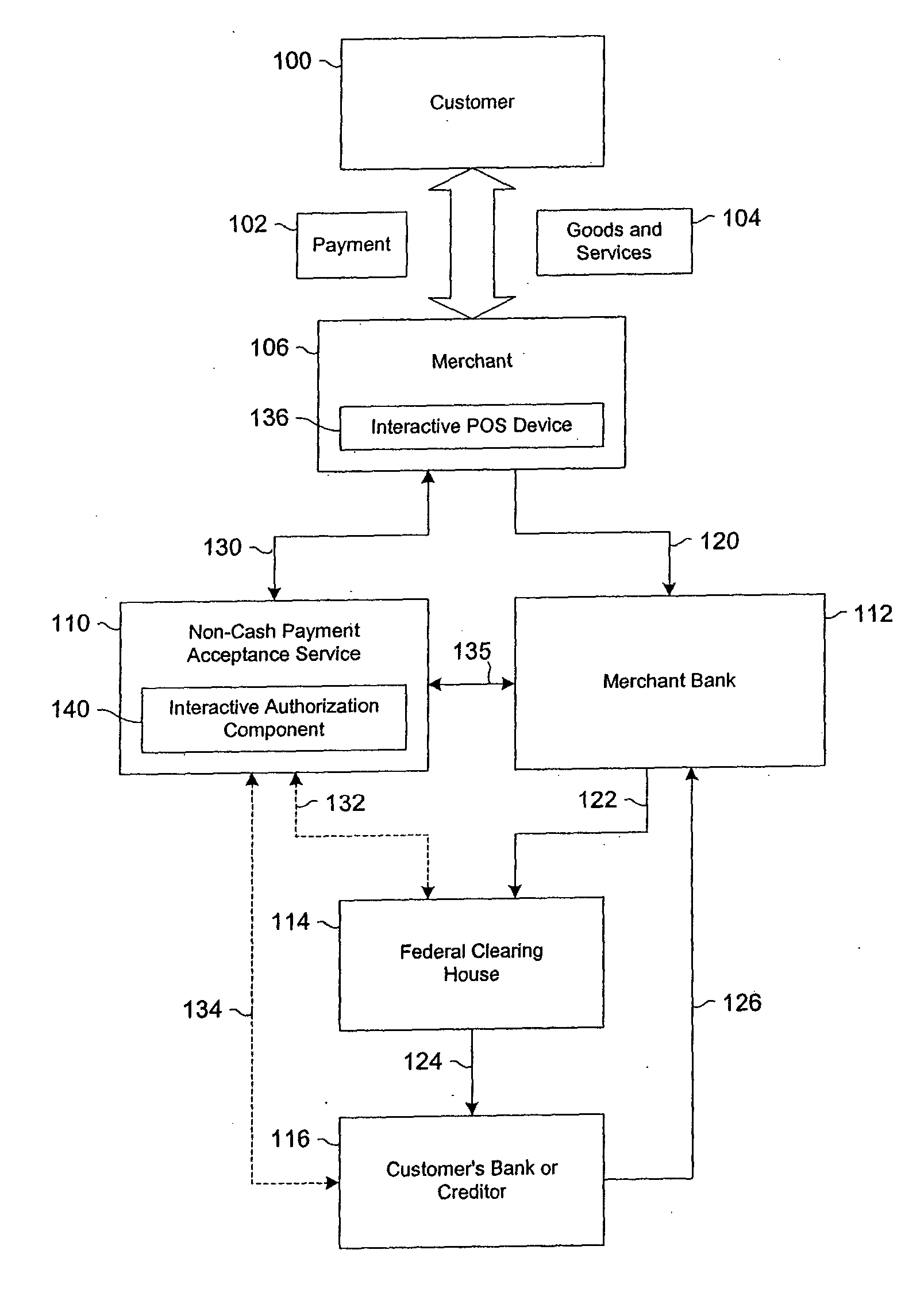

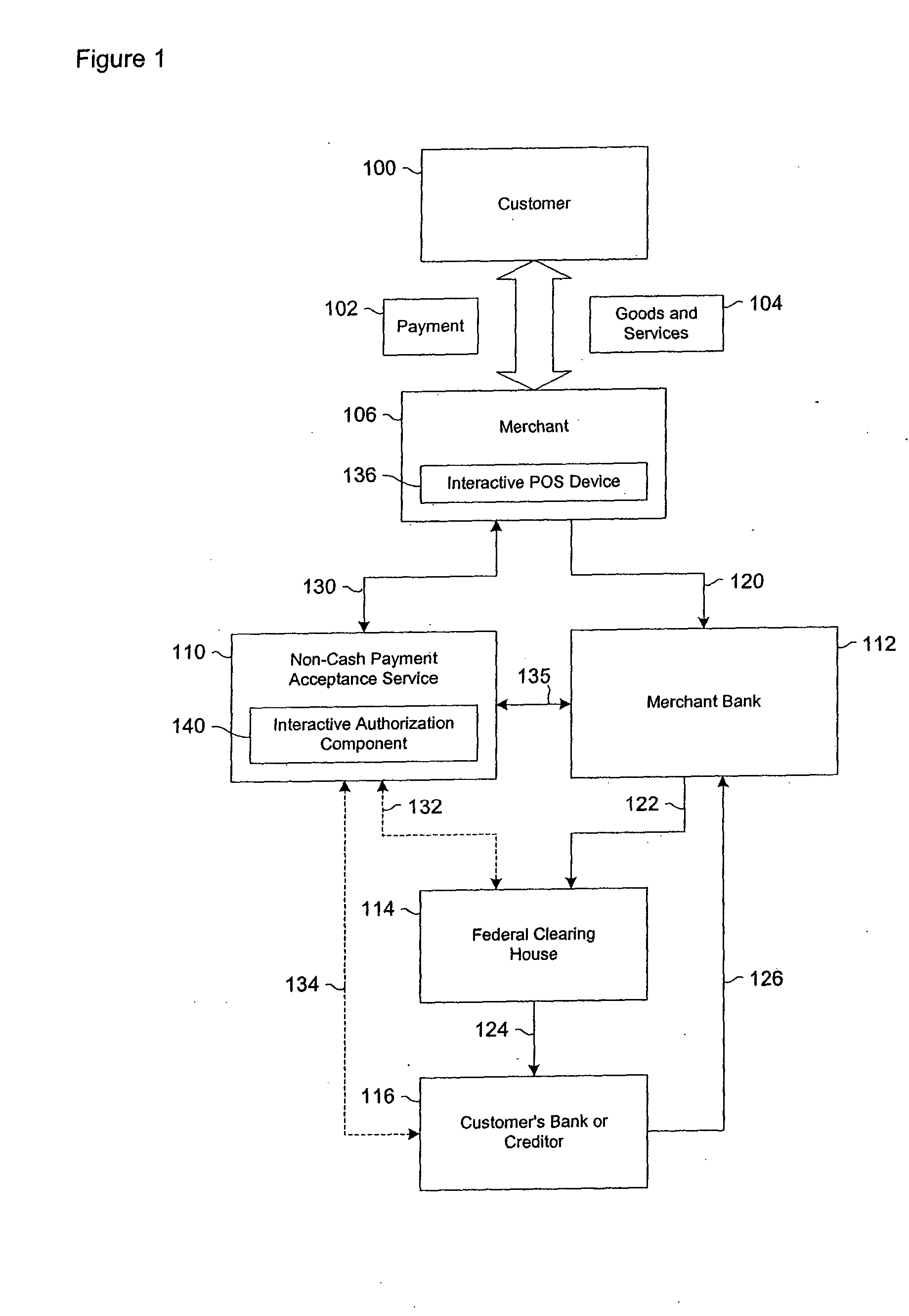

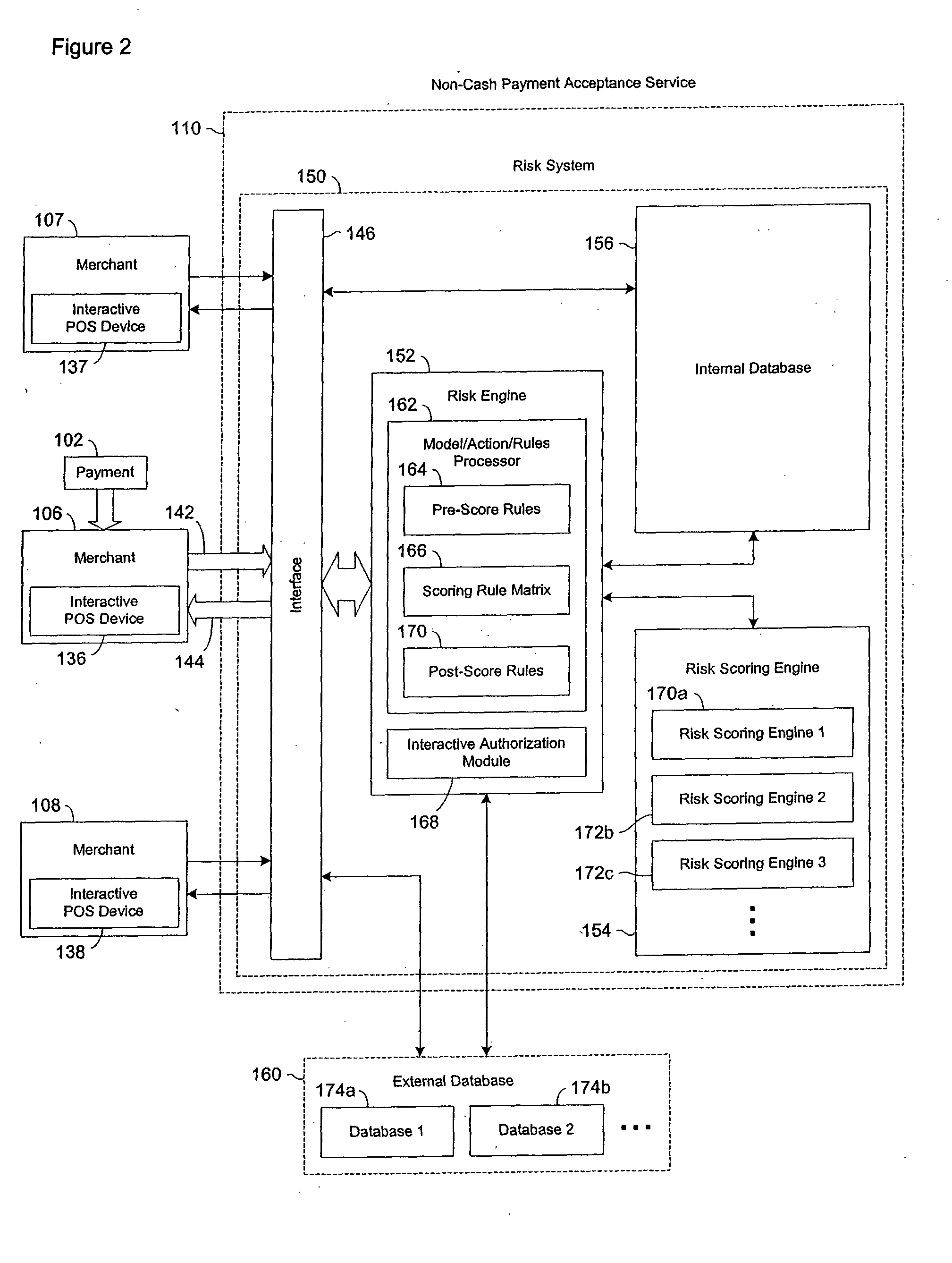

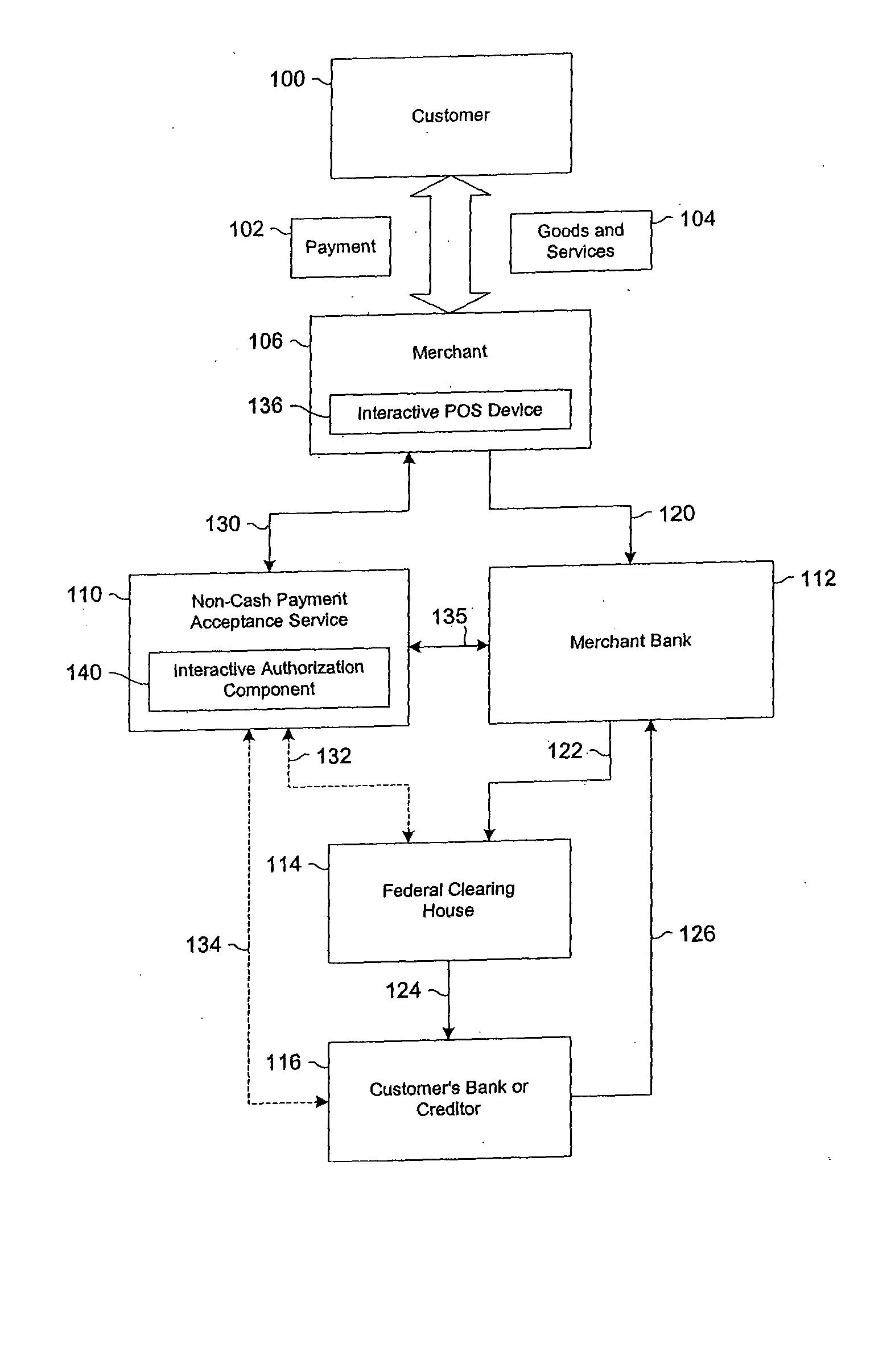

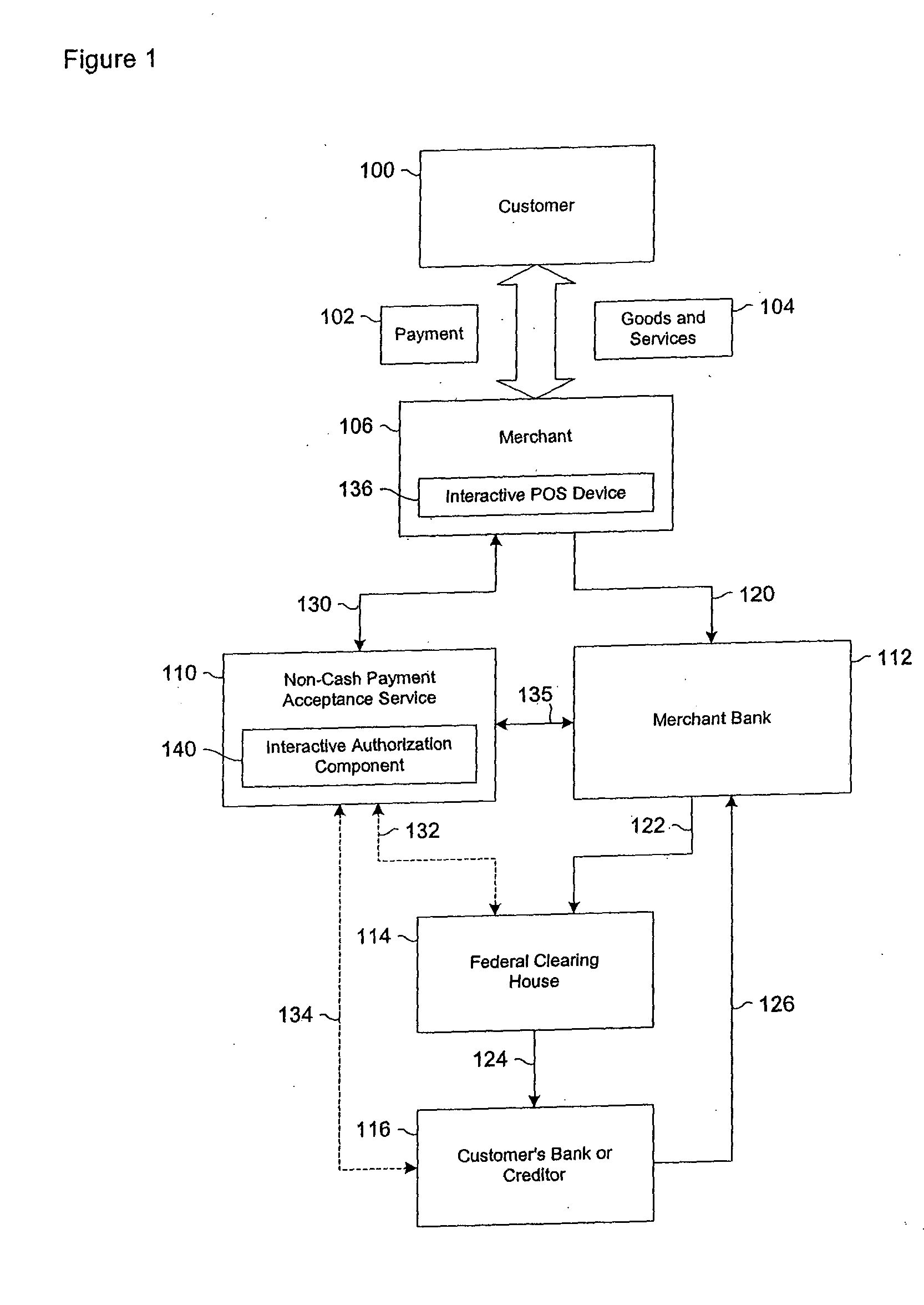

Data validation systems and methods for use in financial transactions

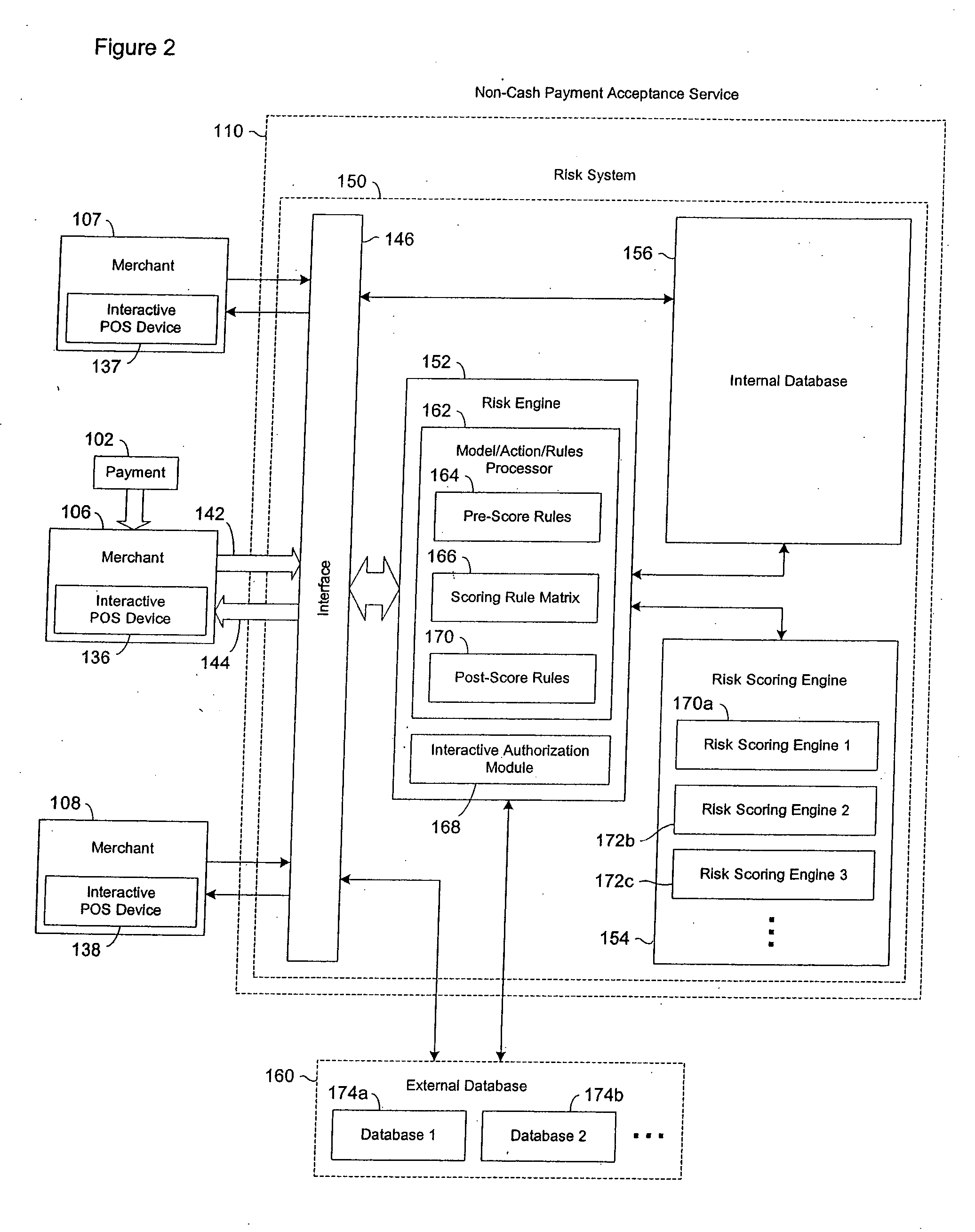

A risk system that performs a risk assessment of a financial transaction to obtain a risk score. Based on the risk score, the risk system may request additional transaction information from a customer and / or a merchant. The request is based at least in part on financial transactions that are of moderate risk to thereby provide a non-cash payment acceptance service with more information to further evaluate the financial transaction risks. Thus, moderately risky financial transactions, that are likely to benefit the non-cash payment acceptance service and the merchant that subscribes to the non-cash payment acceptance service, are authorized for increased profitability and customer satisfaction. Furthermore, the risk system may approve or authorize financial transactions that generally fail standard risk assessments that use a cut-off risk score to divide the financial transactions into either approved or declined groups. As a result, the risk system is capable of re-evaluating some of the moderate risk cases for the purpose of securing beneficial financial transactions.

Owner:FIRST DATA

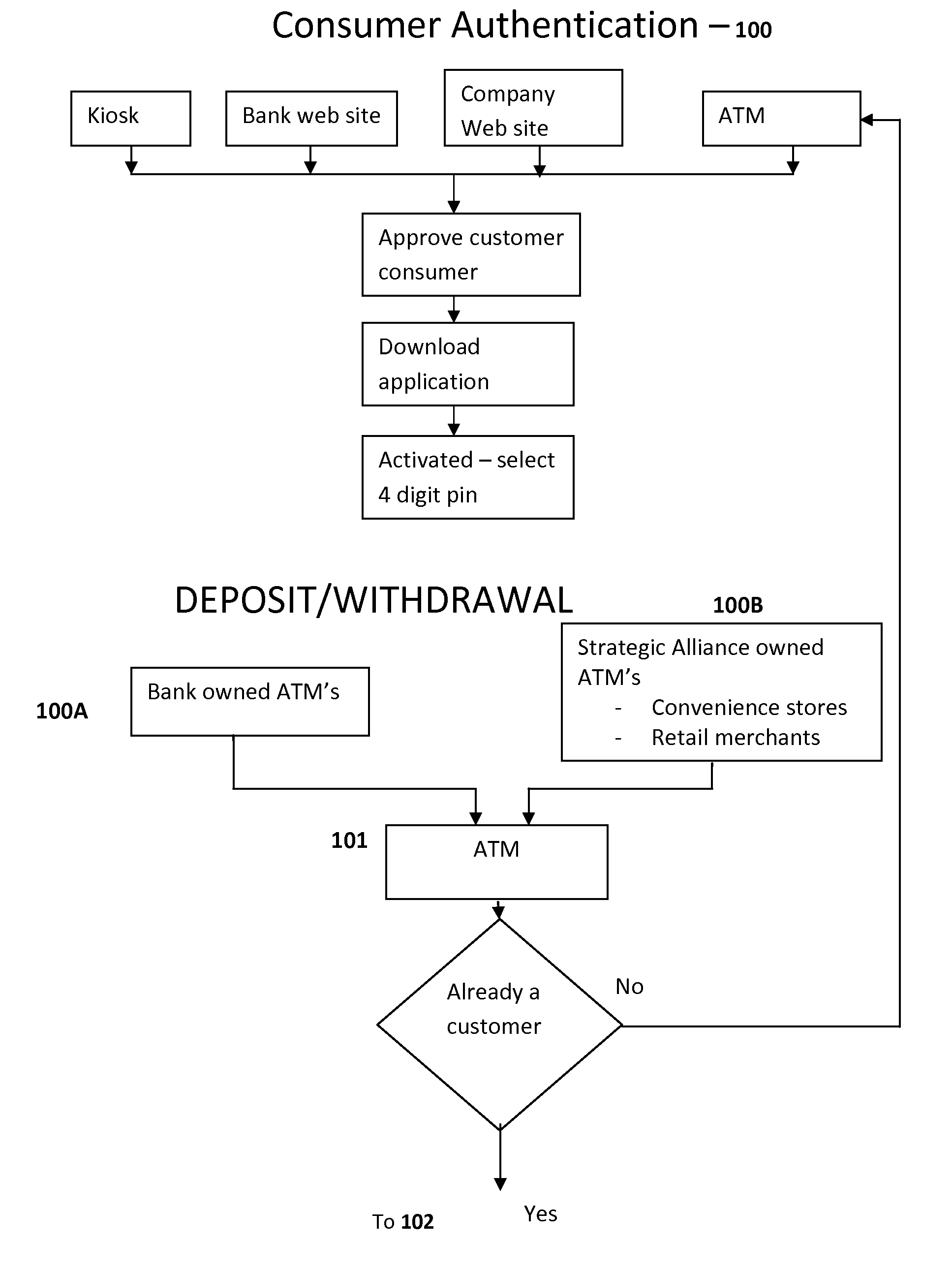

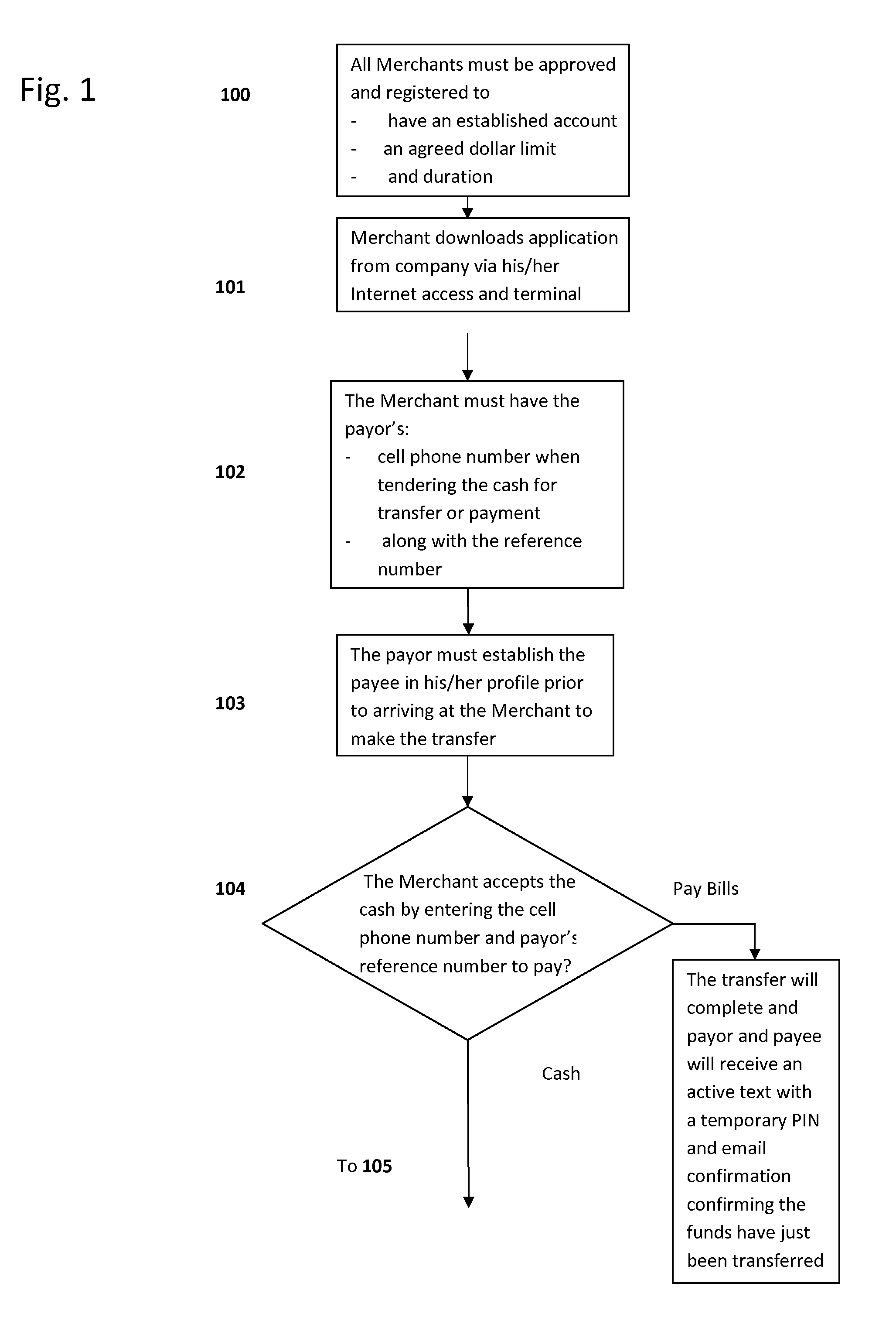

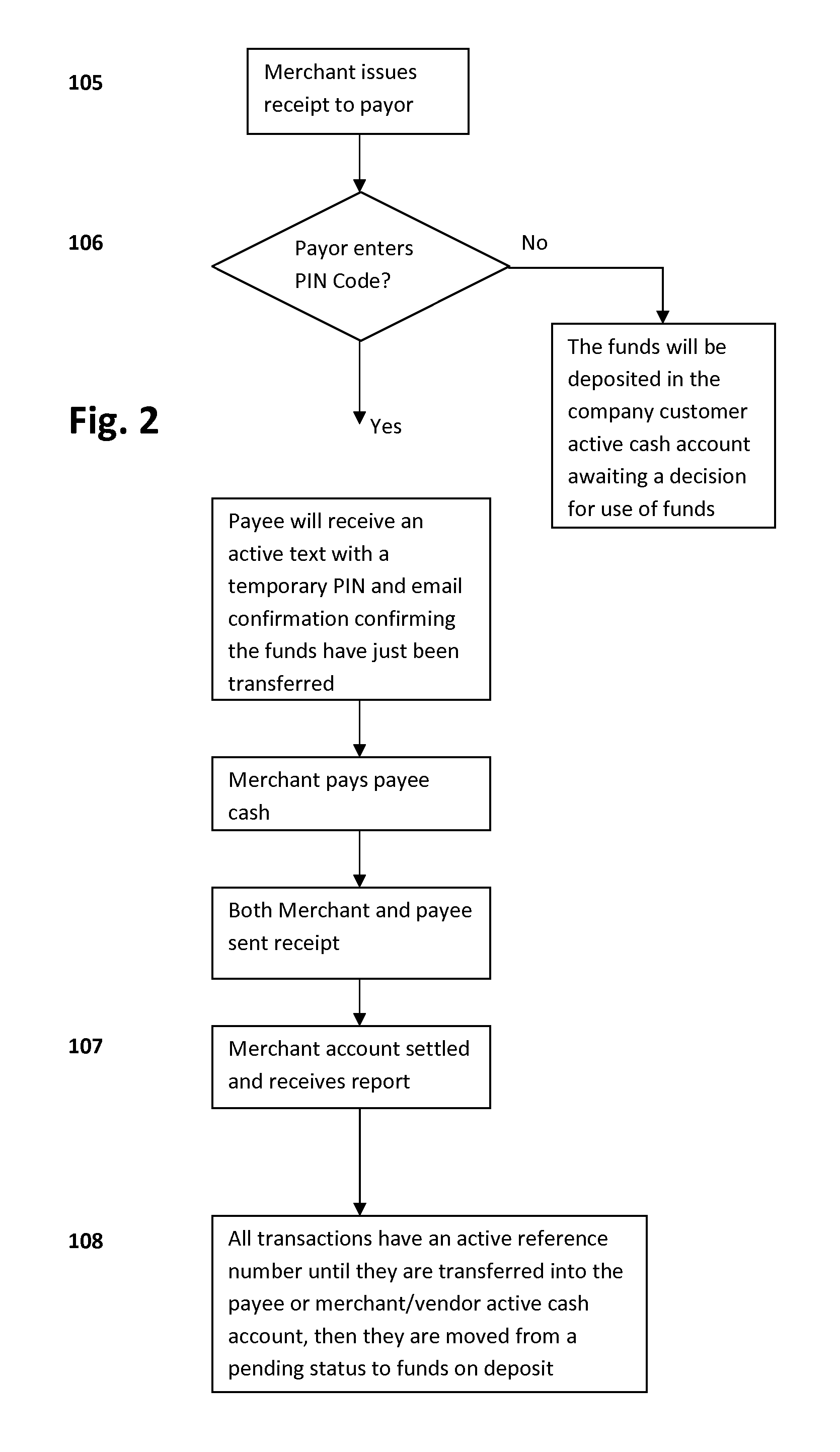

ATM/KIOSK Cash Acceptance

In one aspect, this invention relates to a new method for using a mobile telephone, in conjunction with a payment transaction server, as an authentication and cash payment device of a cash deposit made into an ATM / KIOSK for a variety of financial transactions where a cash payment is desired. Further, the transaction systems and methods for mobile telephone devices described herein allow a mobile telephone to participate in payment transactions in a manner that helps prevent identify theft and without relying on transferring amounts to / from one stored value account to another. It is emphasized that this abstract is provided to enable a searcher to quickly ascertain the subject matter of the technical disclosure and is submitted with the understanding that it will not be used to interpret or limit the scope or meaning of the claims.

Owner:GLOBAL 1 ENTERPRISES

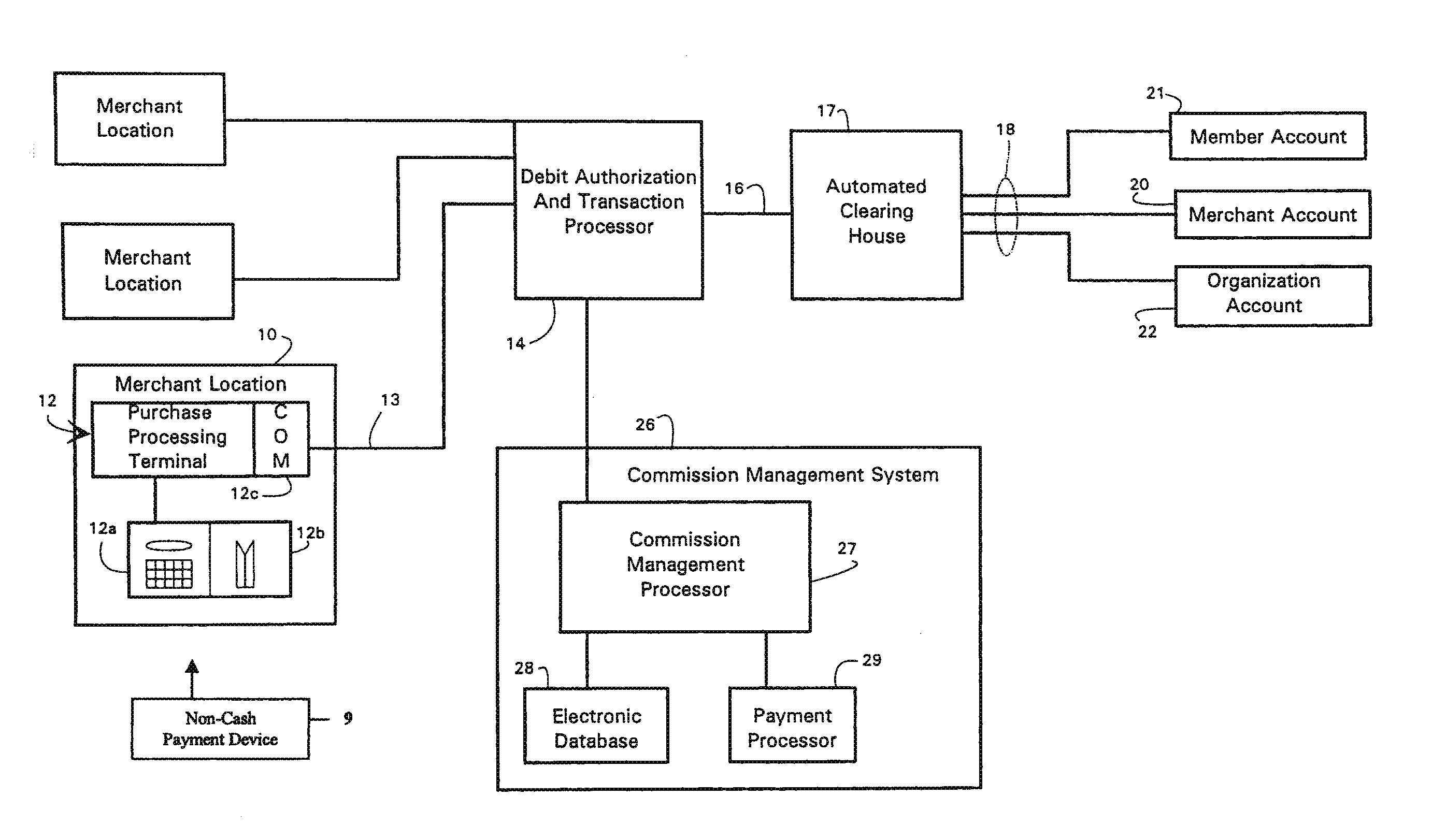

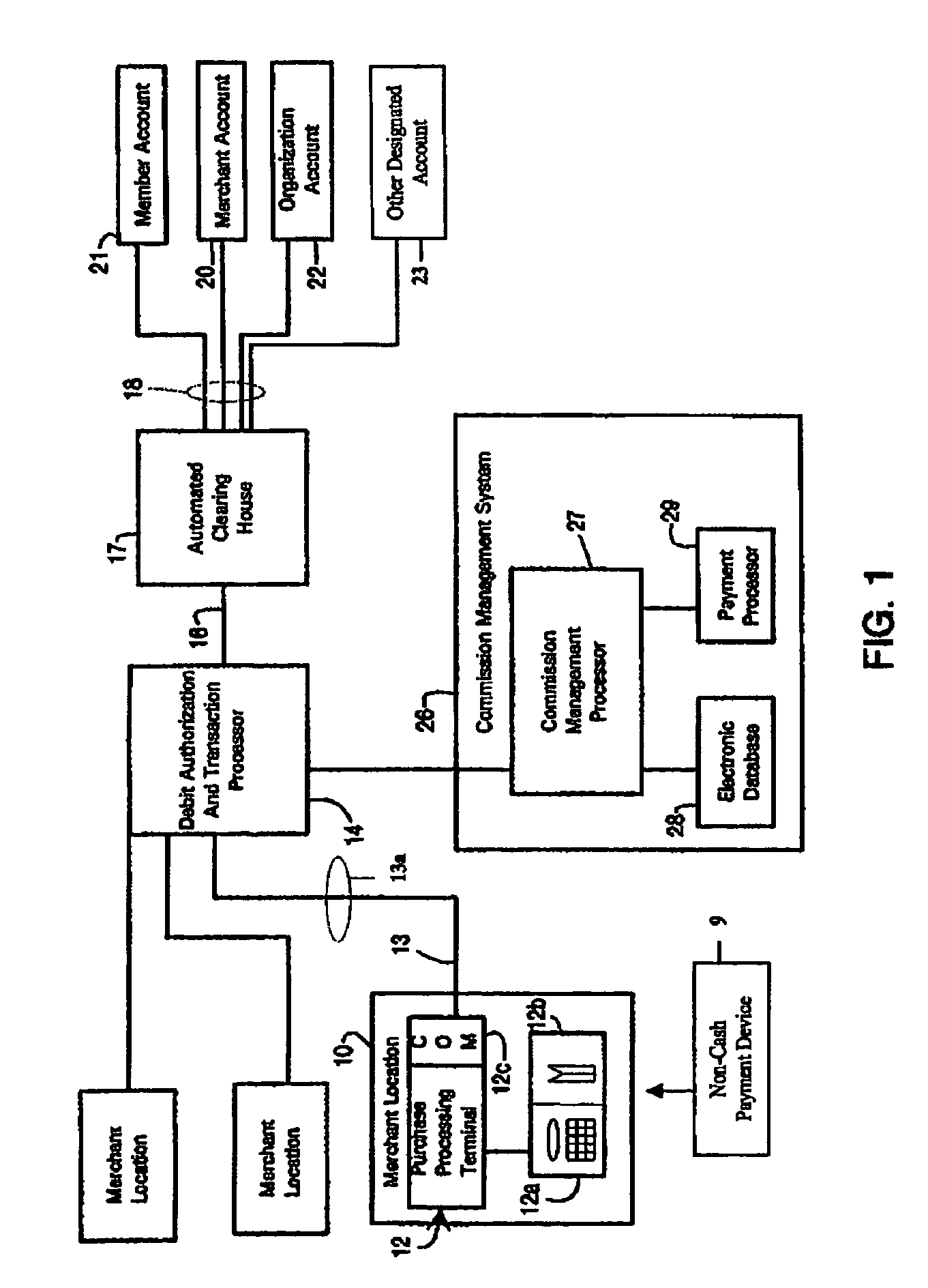

Non-cash transaction incentive and commission distribution system

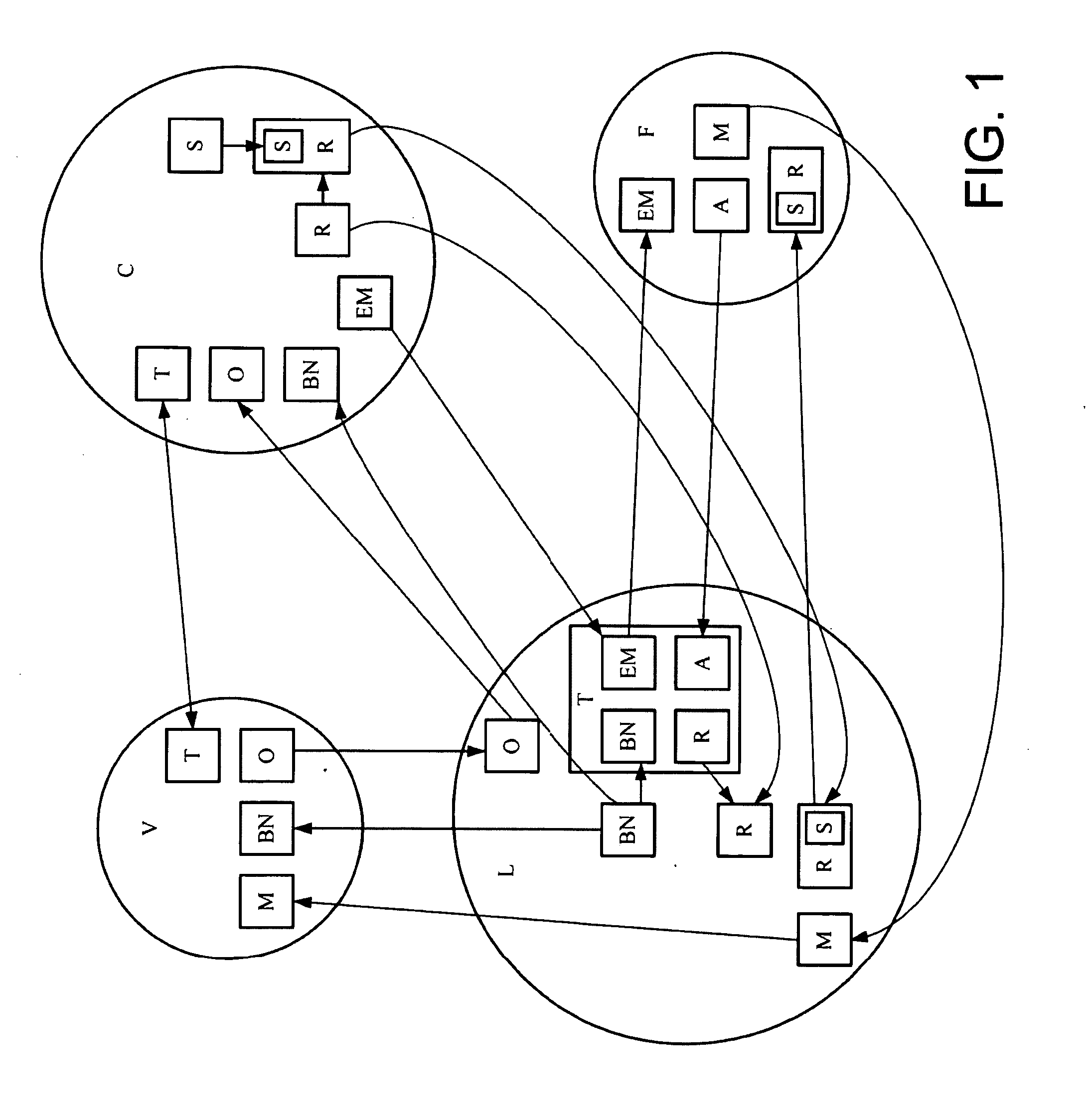

InactiveUS20090216640A1Complete banking machinesDiscounts/incentivesNetwork structureDistribution system

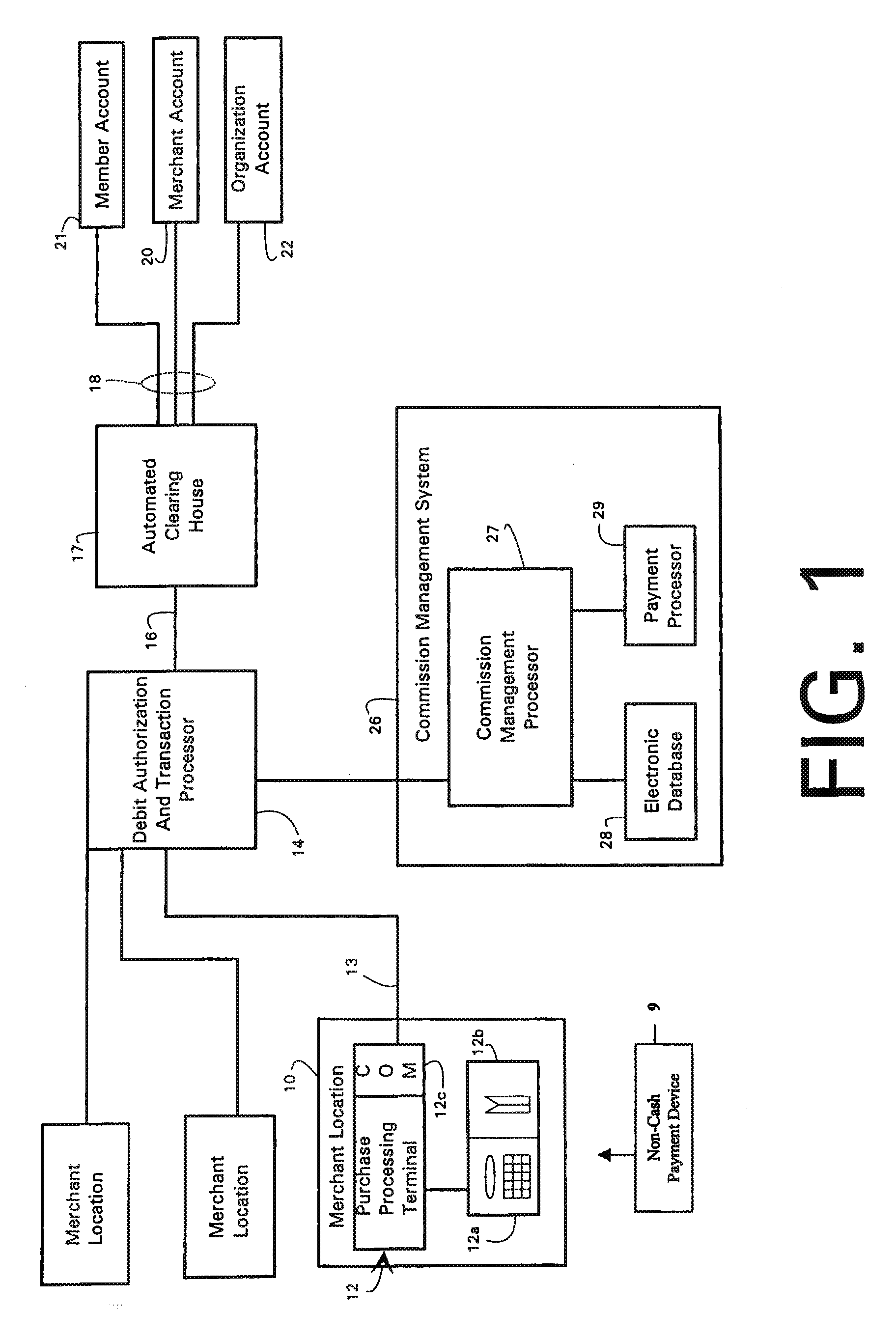

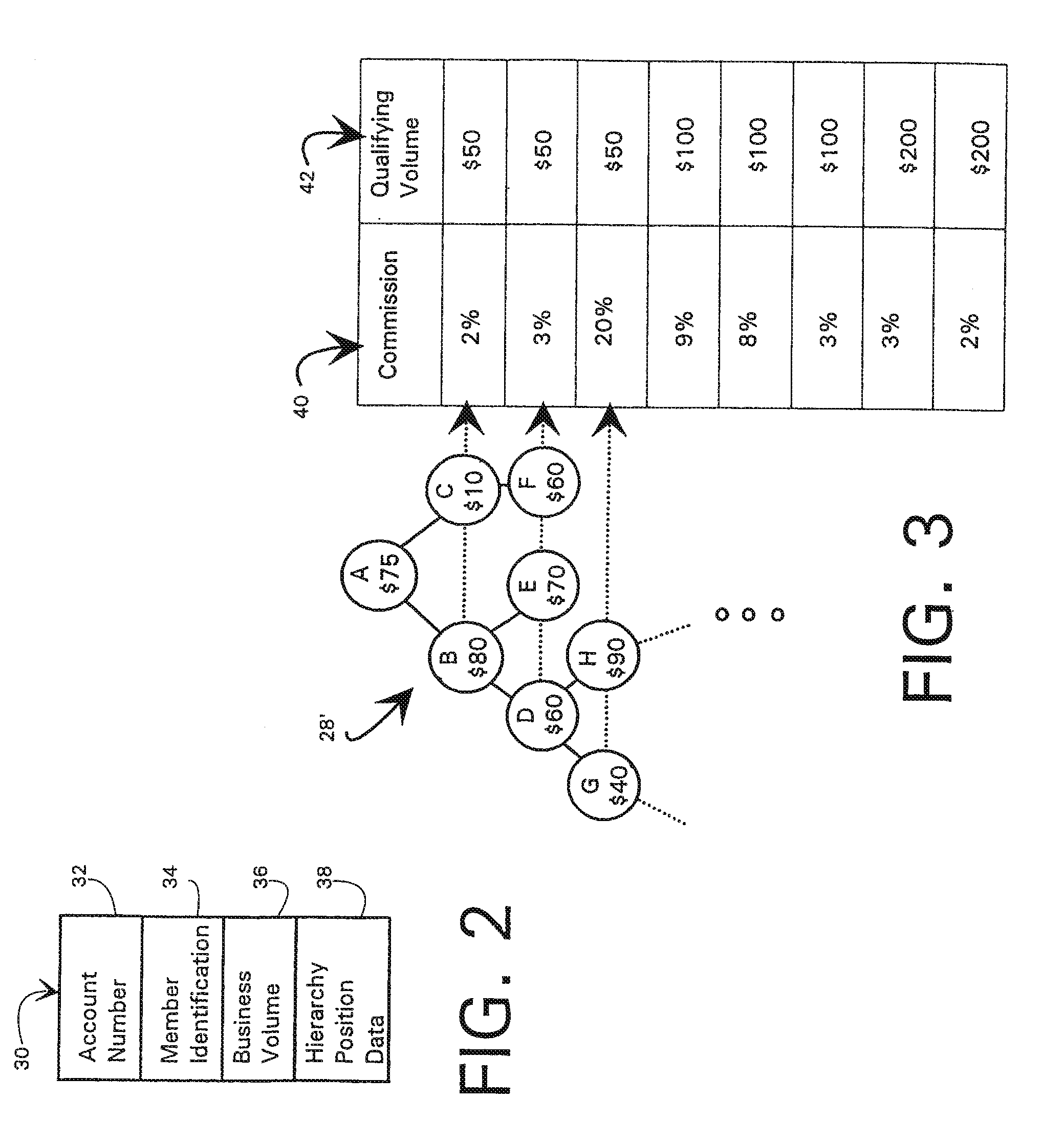

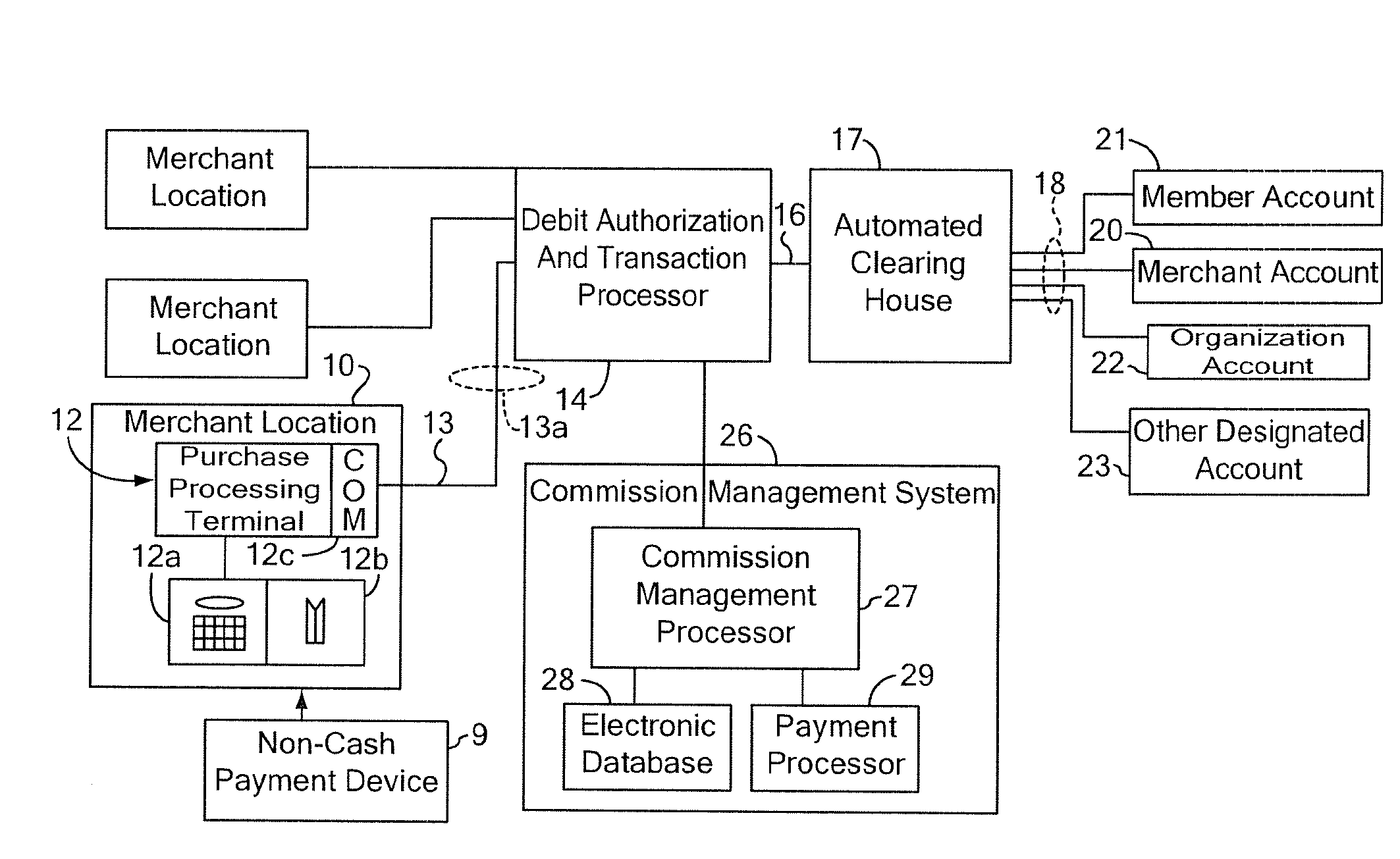

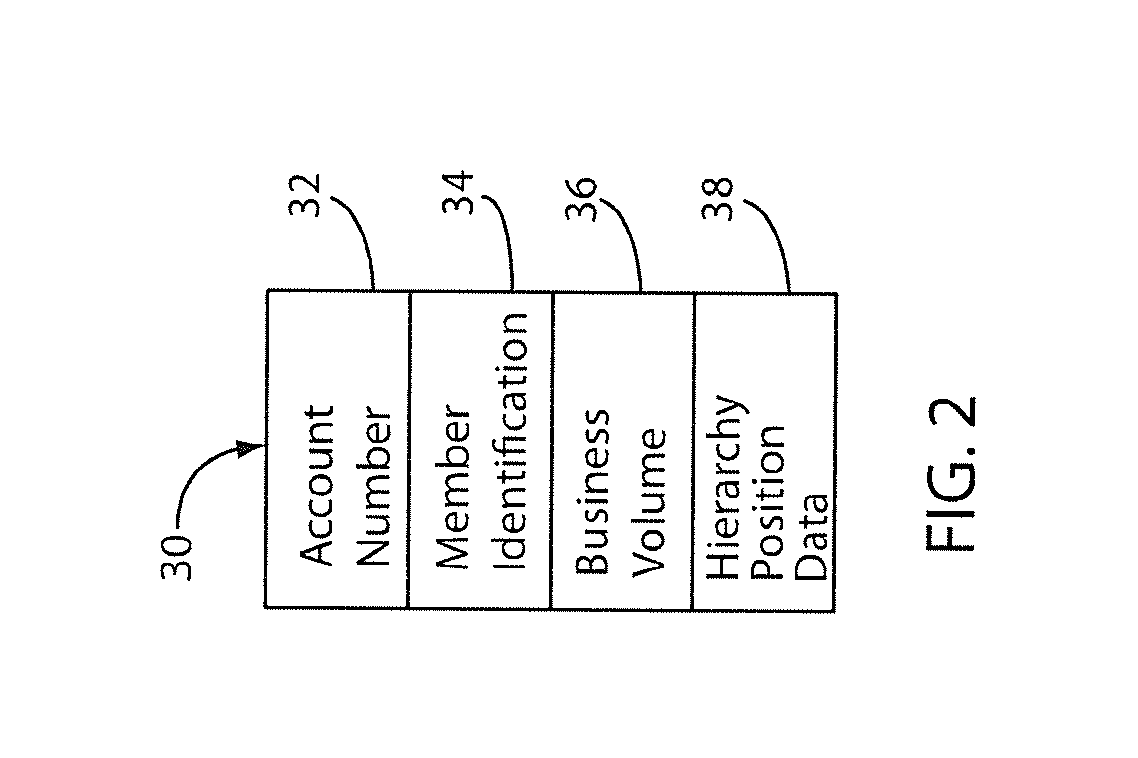

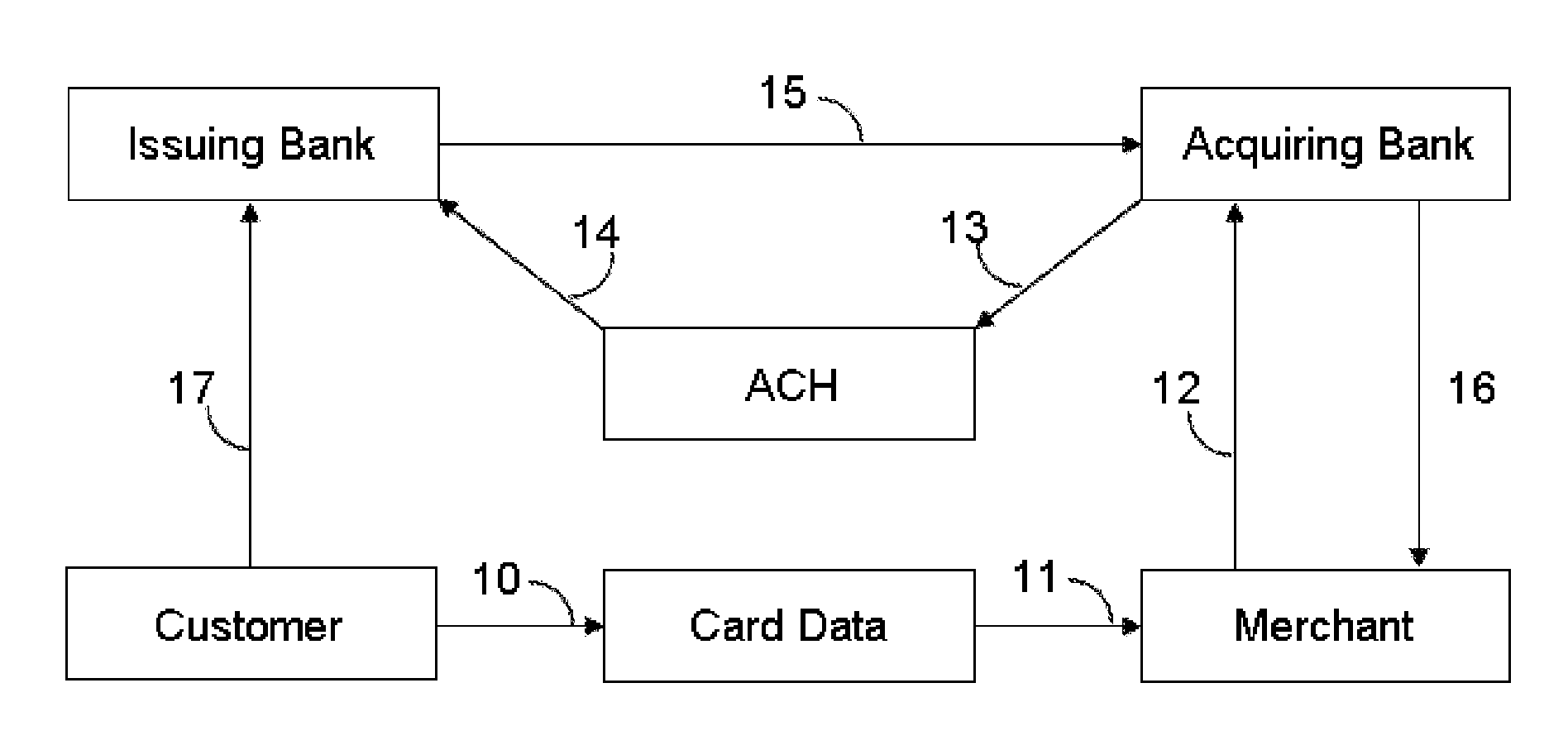

An electronic fund transfer system is disclosed wherein commissions for point-of-sale purchase transactions are determined and distributed to members of an organizational network for promoting use of a non-cash payment device that is tangible for effecting purchase transactions. Purchase data is electronically transmitted from the point-of-sale to an automated clearing house for effecting fund transfers to prepare the purchase, and also to a commission management system. The commission management system maintains an electronic database reflecting the structure of the organizational network, and further determines the distribution of purchase commissions according to a predetermined schedule of proportions relating to the position and business volume of each member of the network. The commission management system further comprises a payment processor for effecting commission payments to the members or to a designated sponsor on a scheduled basis.

Owner:MASI LARRY A

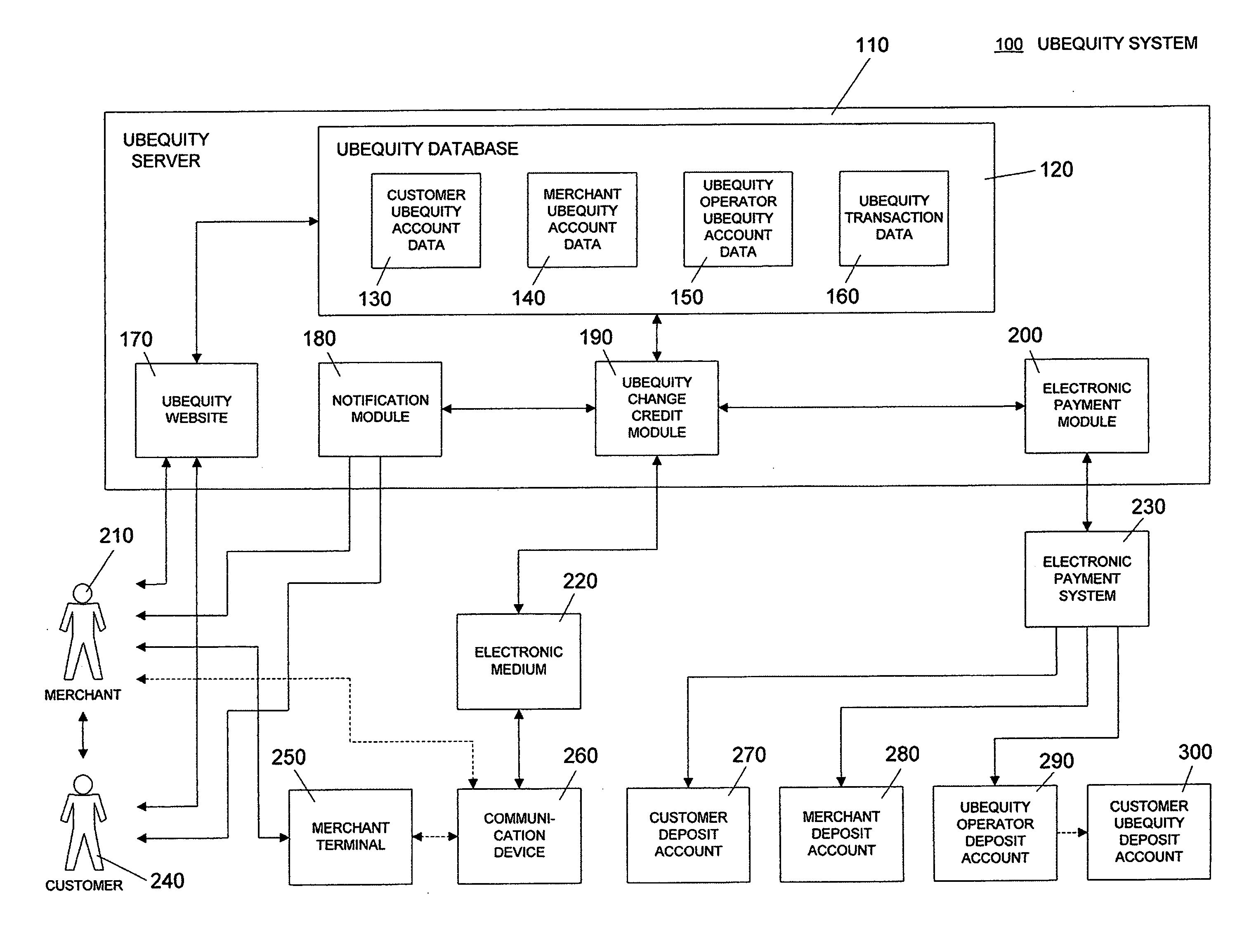

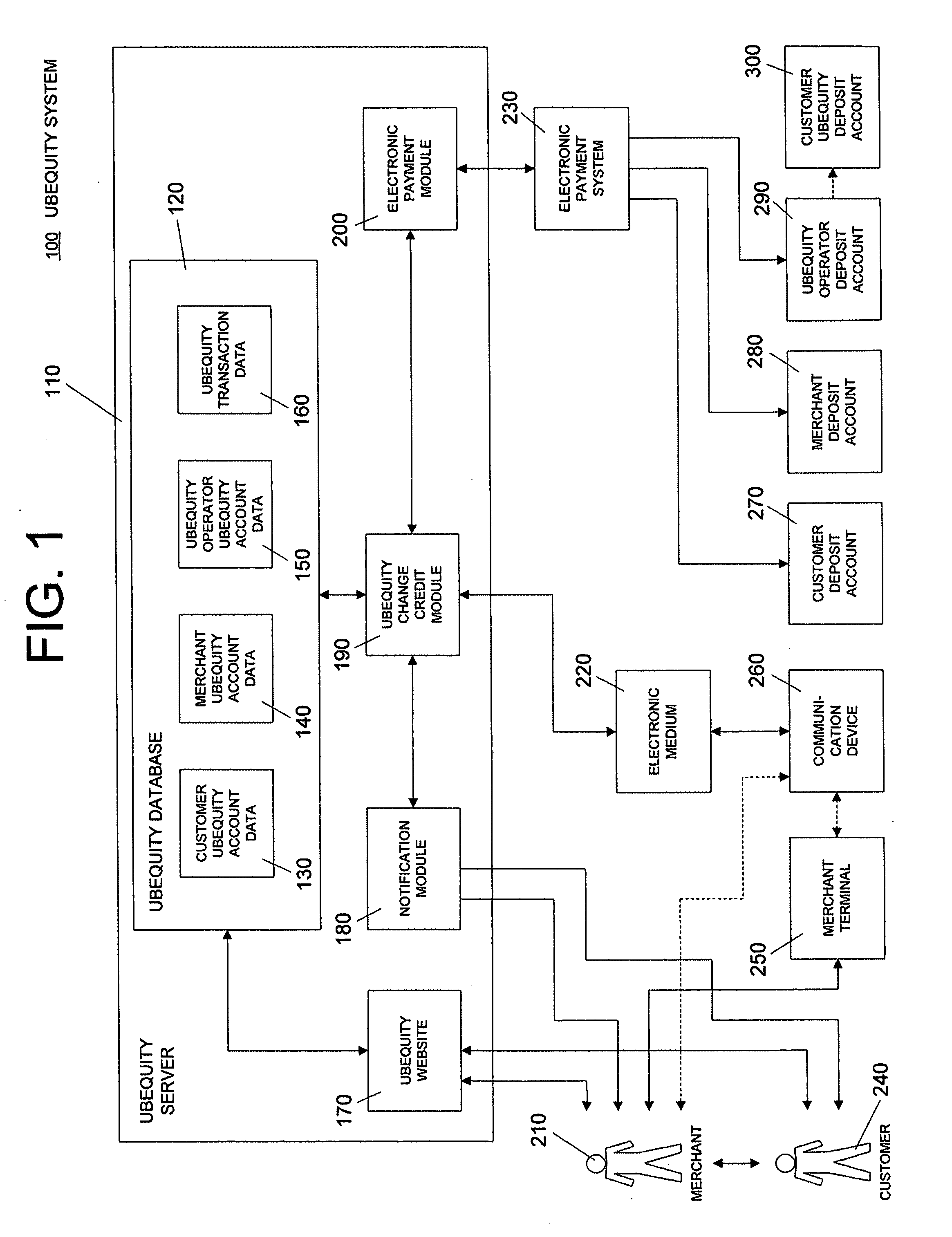

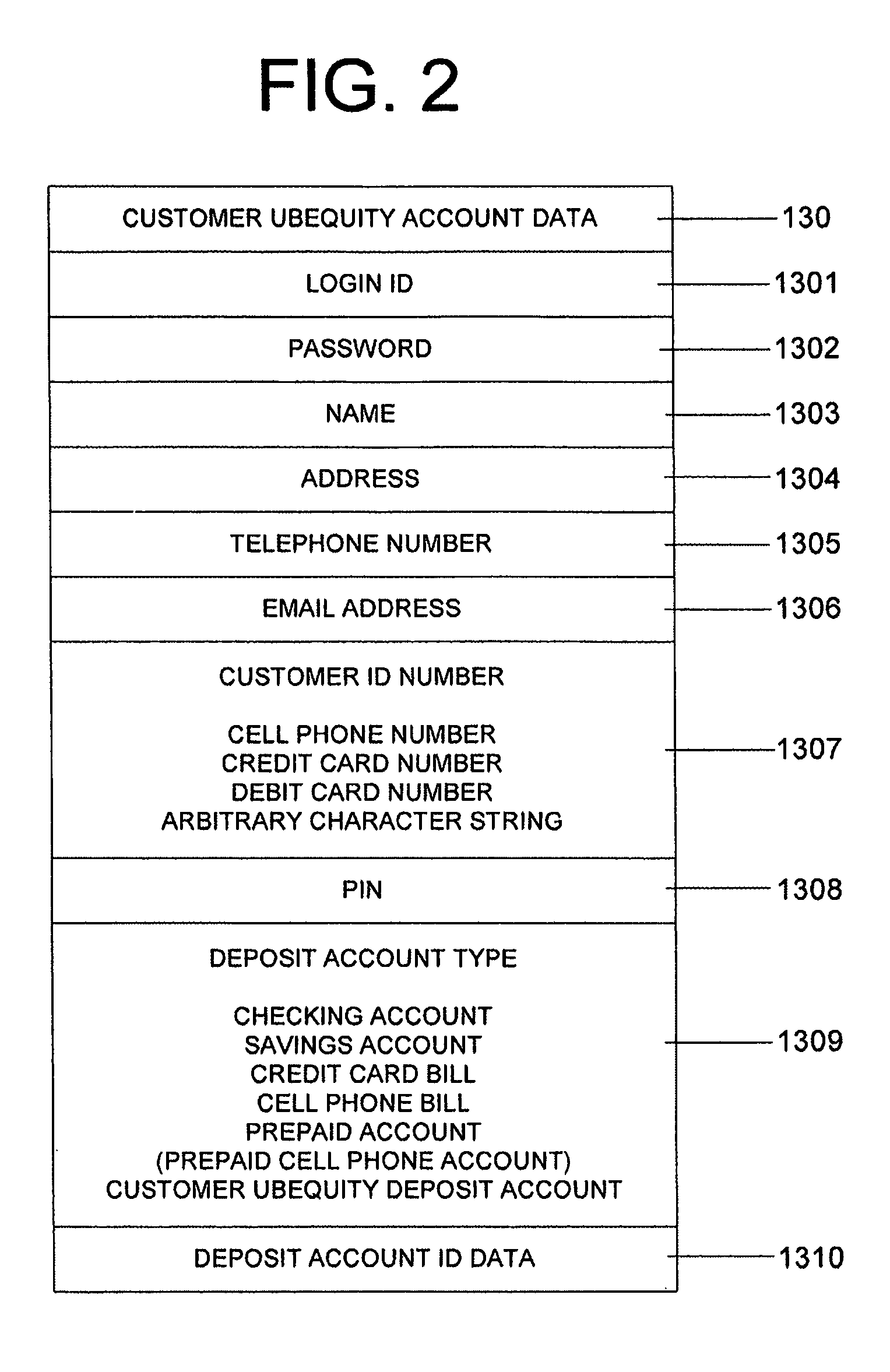

System and method of reducing or eliminating change in cash transaction by crediting at least part of change to buyer's account over electronic medium

InactiveUS20070156579A1Efficient reductionEliminate effectiveFinancePayment architectureDatabaseCommunication device

A method of reducing or eliminating change in a cash transaction includes receiving a cash payment for an article or a service from a buyer; and crediting at least part of change from the cash payment due the buyer to an account of the buyer over an electronic medium. A system of reducing or eliminating change in a cash transaction includes a merchant terminal that processes a cash payment received from a buyer for an article or a service; a communication device that sends a message over an electronic medium specifying that at least part of change from the cash payment is to be credited to an account of the buyer; and a change credit apparatus that credits the at least part of the change to the buyer's account.

Owner:UBEQUITY

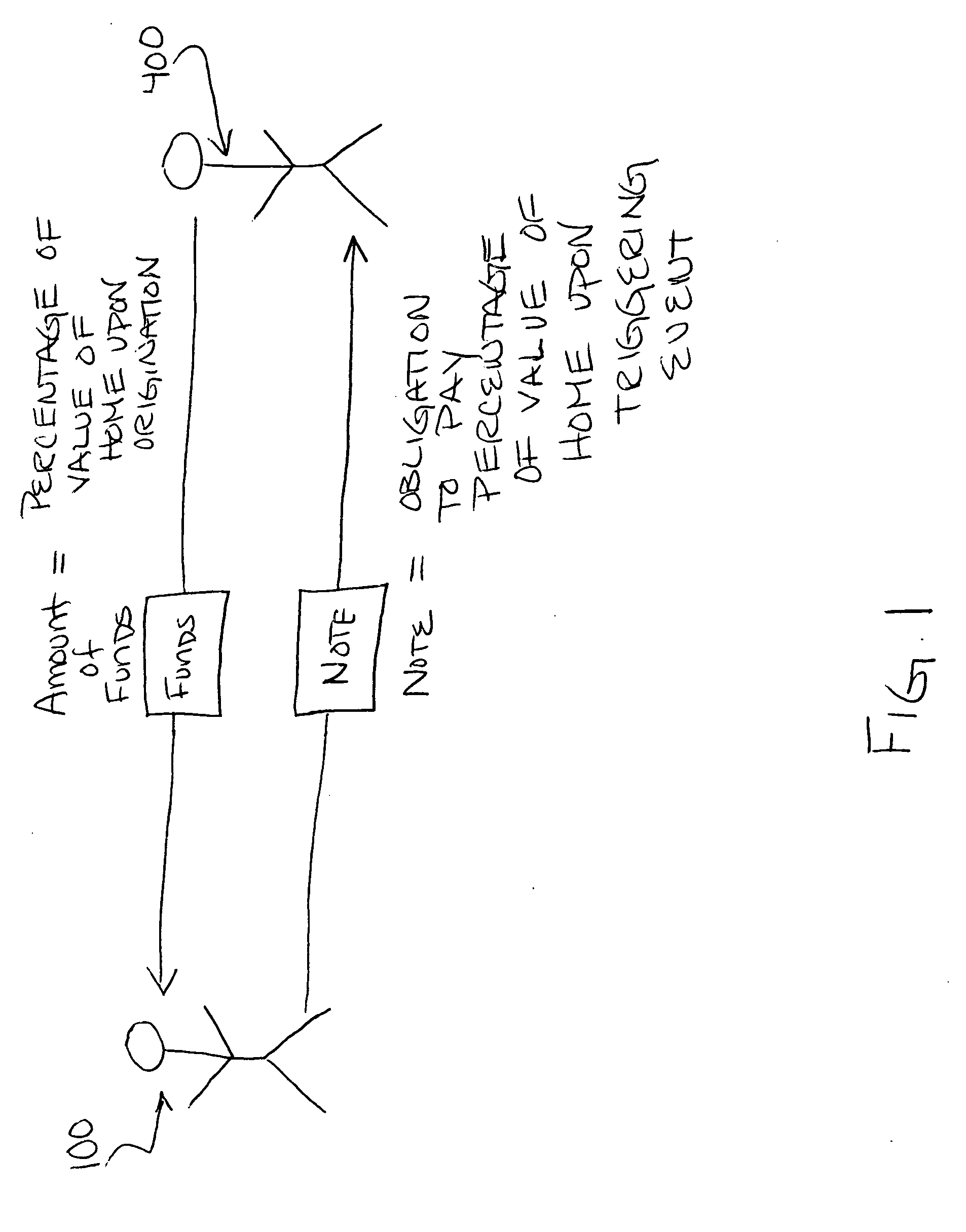

Methods and systems for originating and scoring a financial instrument

A financial instrument exchanged between an owner of real estate and a source of capital. A request for a cash payment is received from the owner. The cash payment is disbursed by the source of capital to the owner. The financial instrument is originated from the owner to the source of capital. The cash payment comprises an amount equal to a percentage of a value of the property measured upon the origination of the financial instrument. The financial instrument comprises an obligation of the owner to pay to the source of capital, at a time associated with a triggering event, a single payment in an amount equal to a percentage of a value of the real estate (including any amounts encumbered by any lien and any amounts unencumbered by any lien) measured at the time associated with the triggering event. The amount of the single payment may be less than the amount of the cash payment.

Owner:NATIONWIDE MUTUAL CAPITAL

Non-cash transaction incentive and commission distribution system

An electronic fund transfer system is disclosed wherein commissions for point-of-sale purchase transactions are determined and distributed to members of an organizational network for promoting use of a non-cash payment device for effecting purchase transactions. Purchase data is electronically transmitted from the point-of-sale to an automated clearing house for effecting fund transfers to prepare the purchase, and also to a commission management system. The commission management system maintains an electronic database reflecting the structure of the organizational network, and further determines the distribution of purchase commissions according to a predetermined schedule of proportions relating to the position and business volume of each member of the network. The commission management system further comprises a payment processor for effecting commission payments to the members or to a designated sponsor on a scheduled basis.

Owner:MASI LARRY A

Gaming Method

ActiveUS20070111772A1Improve casino gamingReduce advantageBoard gamesCard gamesHuman–computer interactionCash payment

A gaming method operates to provide expert card-counting information to some or all participants, in exchange for a premium. The premium may be a cash payment, a reduction in the prize amounts or betting odds, some combination of the foregoing, or any other useful remuneration. The house retains its edge via the premium. The method may be implemented for play at a physical or virtual card table.

Owner:INTELLECTUAL VENTURES I LLC

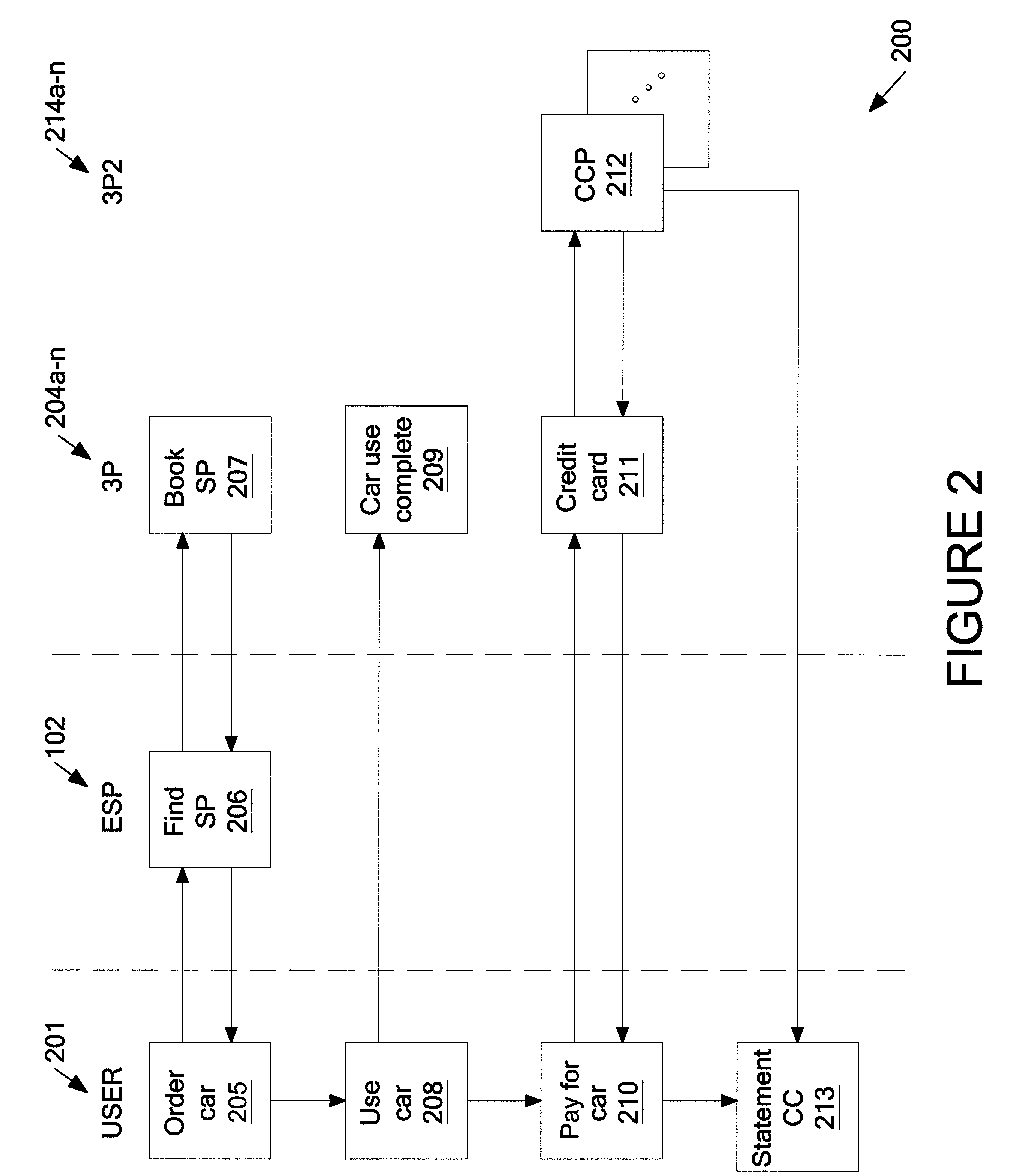

System and Method for Tracking Spending Based on Reservations and Payments

InactiveUS20090006142A1Improve understandingReduce needFinanceReservationsTime schedulePayment transaction

One embodiment provides a method, that may be implemented on a system for obtaining a schedule of bookings made by a user through an electronic service portal; obtaining a schedule of payment transactions to pay for bookings, the payment transactions comprising one or more of a credit card payment, a cash payment, or a payment via a cash card or debit card; and using the schedule of bookings made via the electronic service portal to identify payment transactions reimbursable to the user from a separate entity and generating an expense report of the reimbursable payment transactions.

Owner:REARDEN COMMERCE

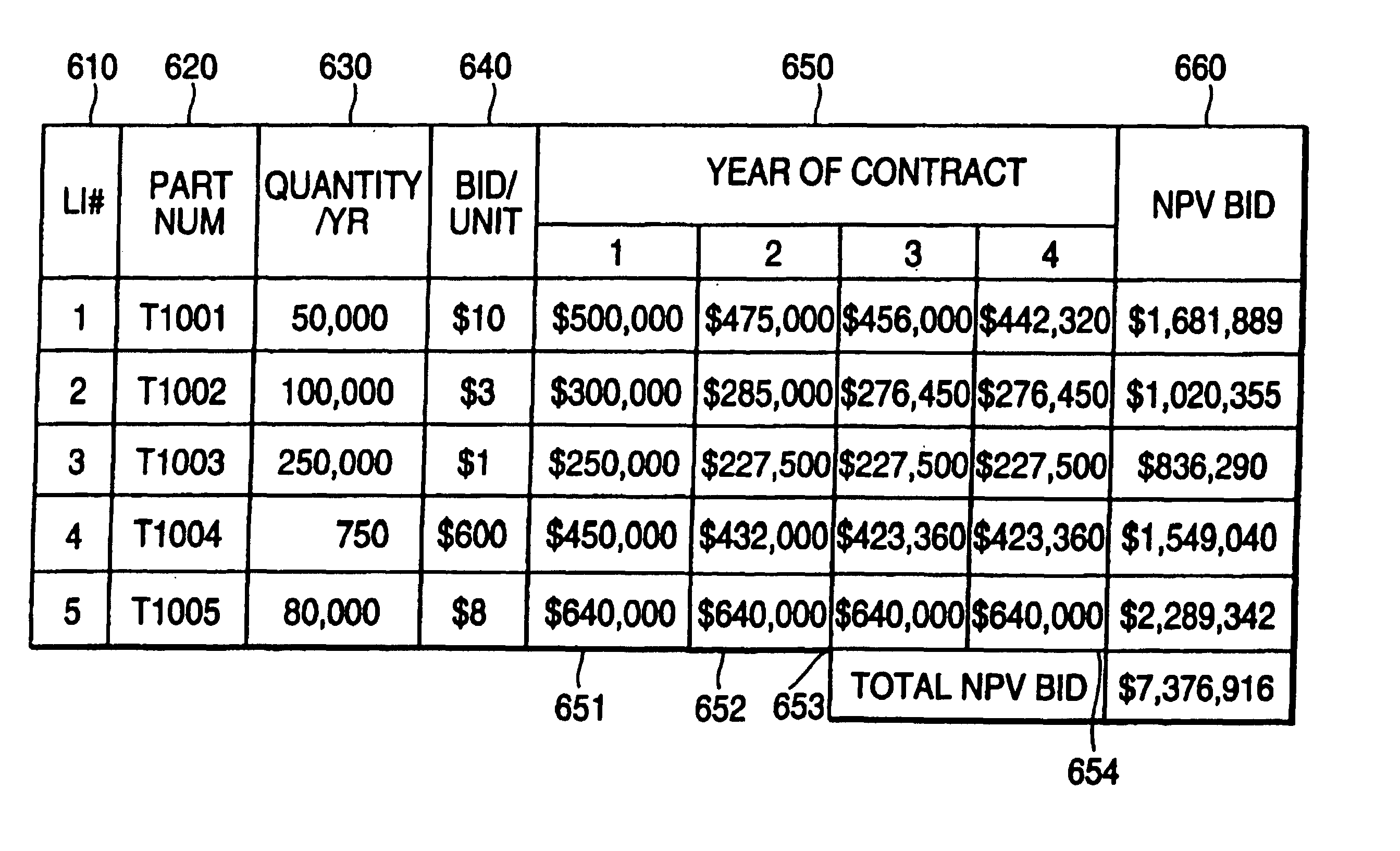

Method and system for conducting electronic auctions with net present value bidding

A method and system for an electronic auction is described. Bids by participating bidders are specified over multiple contract term segments (e.g., years), and define a pattern of cash payments over time. The auction system converts the defined pattern of cash payments over time into a net present value bid. The net present value bids are used to effect a comparison between participating bidders.

Owner:ARIBA INC

Data validation systems and methods for financial transactions

InactiveUS20050080717A1Satisfies needFinanceSpecial data processing applicationsData validationMedium Risk

A risk system that performs a risk assessment of a financial transaction to obtain a risk score. Based on the risk score, the risk system may request additional transaction information from a customer and / or a merchant. The request is based at least in part on financial transactions that are of moderate risk to thereby provide a non-cash payment acceptance service with more information to further evaluate the financial transaction risks. Thus, moderately risky financial transactions, that are likely to benefit the non-cash payment acceptance service and the merchant that subscribes to the non-cash payment acceptance service, are authorized for increased profitability and customer satisfaction. Furthermore, the risk system may approve or authorize financial transactions that generally fail standard risk assessments that use a cut-off risk score to divide the financial transactions into either approved or declined groups. As a result, the risk system is capable of re-evaluating some of the moderate risk cases for the purpose of securing beneficial financial transactions.

Owner:FIRST DATA

Non-cash transaction incentive and commission distribution system

An electronic fund transfer system is disclosed wherein commissions for point-of-sale purchase transactions are determined and distributed to members of an organizational network for promoting use of a non-cash payment device that is tangible for effecting purchase transactions. Purchase data is electronically transmitted from the point-of-sale to an automated clearing house for effecting fund transfers to prepare the purchase, and also to a commission management system. The commission management system maintains an electronic database reflecting the structure of the organizational network, and further determines the distribution of purchase commissions according to a predetermined schedule of proportions relating to the position and business volume of each member of the network. The commission management system further comprises a payment processor for effecting commission payments to the members or to a designated sponsor on a scheduled basis.

Owner:MASI LARRY A

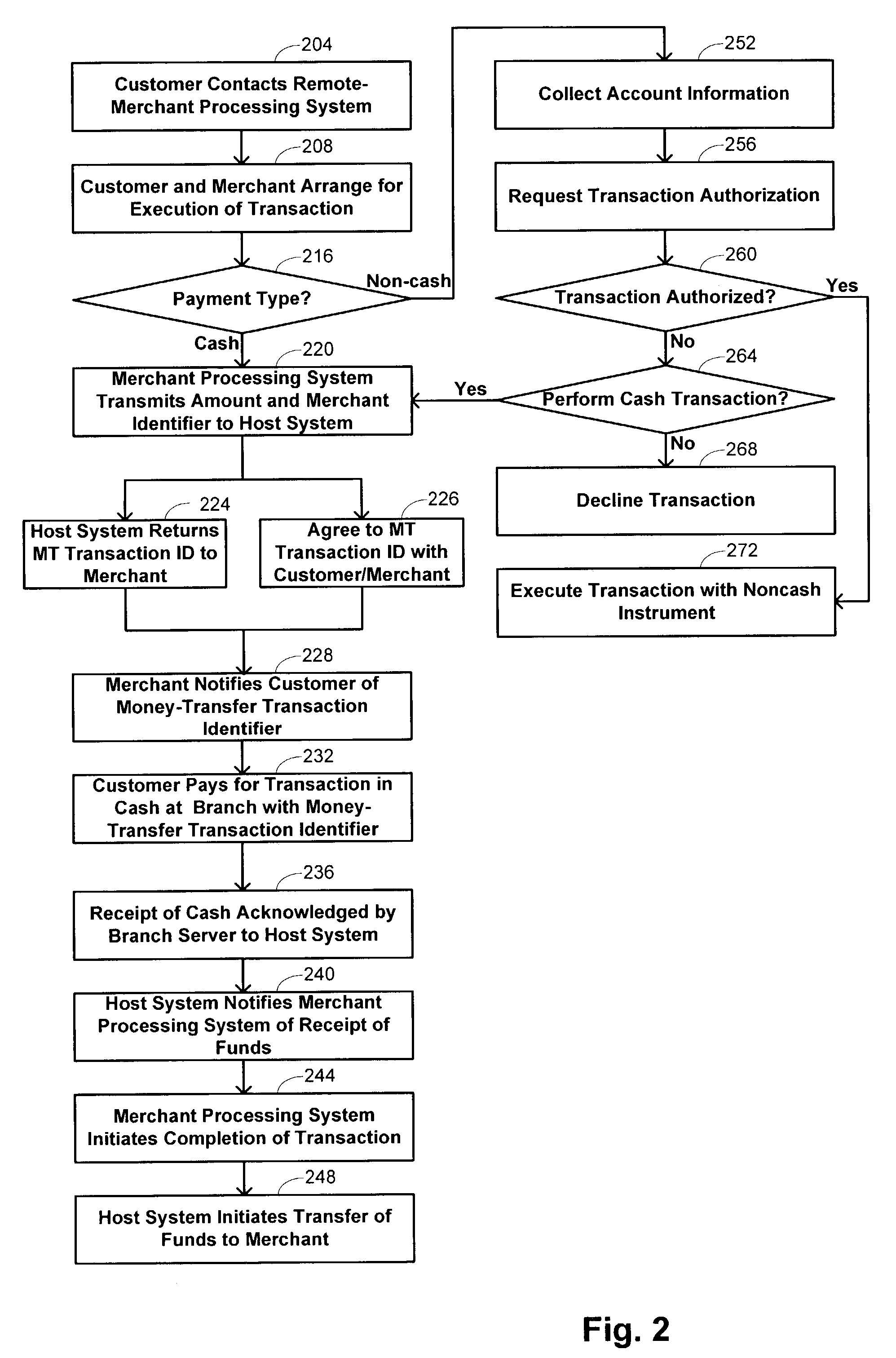

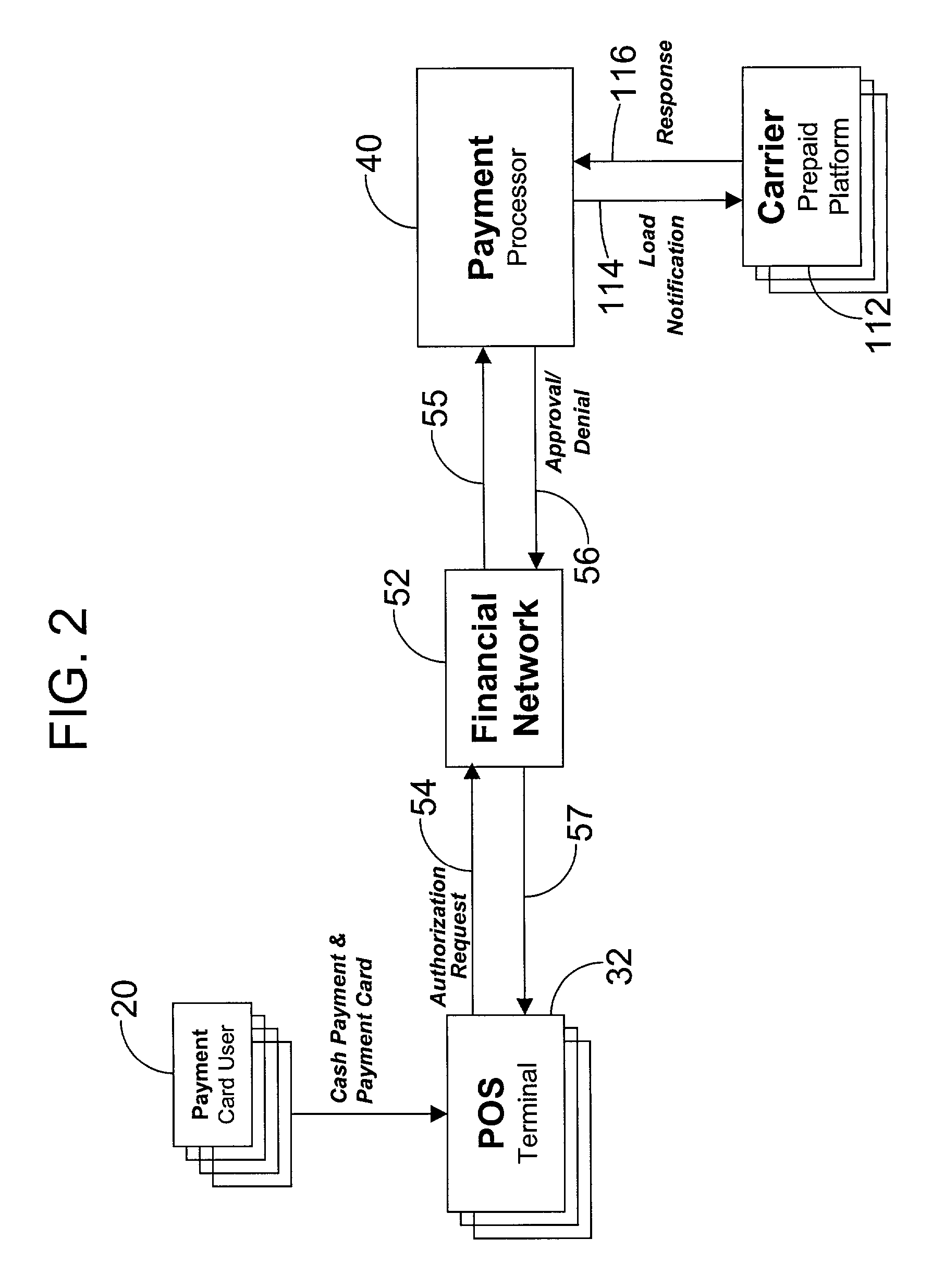

Cash payment for remote transactions

Methods and systems are provided for executing a remote transaction between a merchant and a customer. A designation of a monetary amount for the remote transaction and an identification of the merchant is transmitted from a merchant processing system to a host system controlled by a money-transfer provider. A money-transfer transaction identifier identifying a prepared money-transfer transaction for transfer of the monetary amount is established at the merchant processing system. The money-transfer transaction identifier is provided to the customer. Performance of merchant obligations in accordance with the remote transaction is initiated after notification to the merchant processing system of receipt of a cash payment made by the customer towards the prepared money-transfer transaction.

Owner:THE WESTERN UNION CO

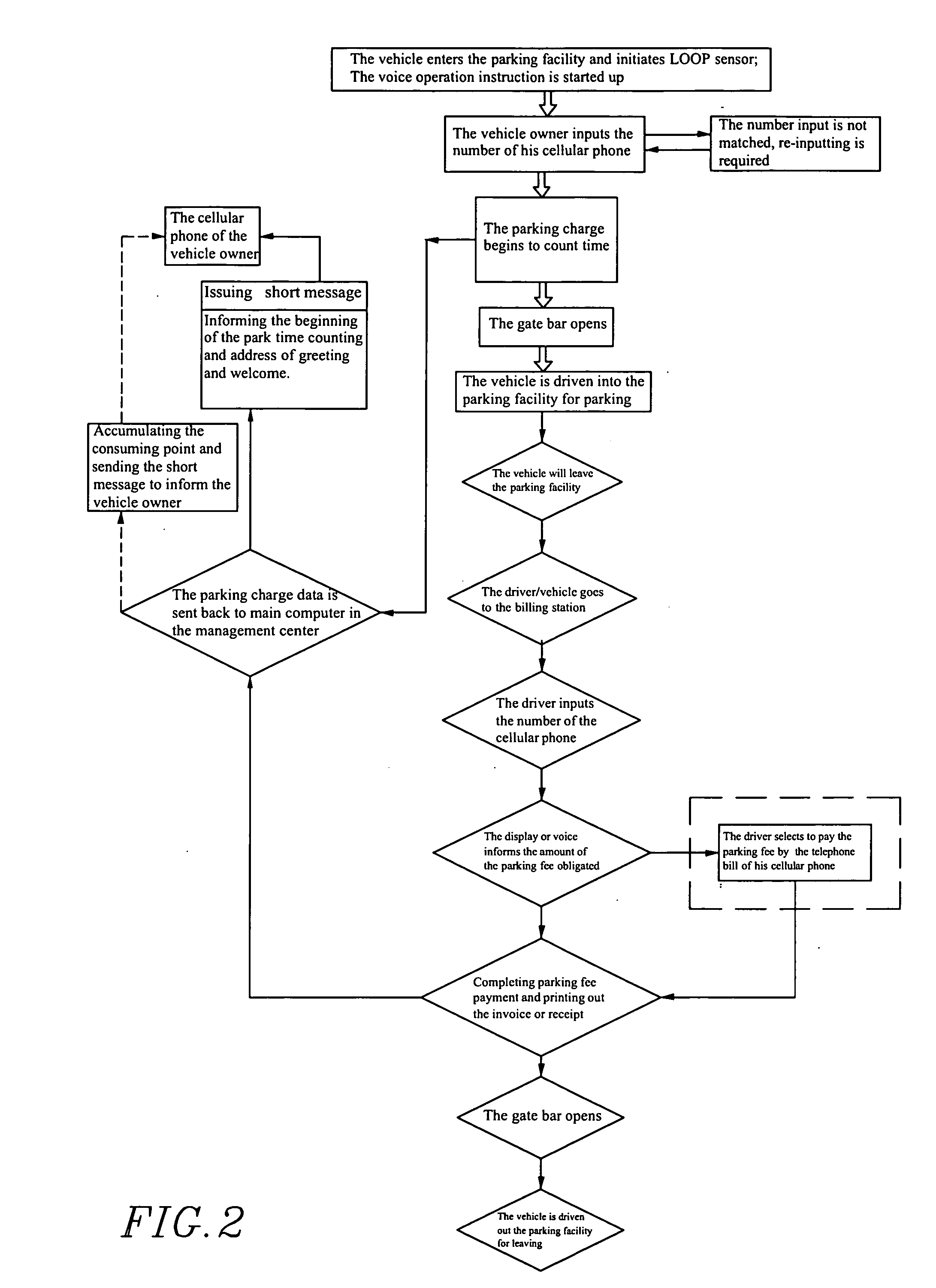

Billing management system of parking facility

InactiveUS20060259354A1Eliminates losingEliminates printingTicket-issuing apparatusPayment architectureInvoiceVoucher

A billing management system of parking facility mainly comprises: The vehicle enters the parking facility and initiates LOOP sensor to start up the voice operation instruction; The vehicle owner inputs the number of his cellular phone and selects the charging method for opening the gate bar to drive it into the parking facility for parking; When picking the vehicle to leave, the vehicle owner re-input the same cellular phone number as that during entering the parking facility so as to let the management system display or voice inform parking duration and the amount of the parking fee obligated; Next, the vehicle owner selects to pay the parking fee by cash payment on-site or by the telephone bill of his cellular phone to complete the parking fee payment so as to let the system print out the invoice or receipt; Then, the exit gate bar will open to let the vehicle owner drive his vehicle out of the parking facility. That effectively eliminates the printing and losing possibility of the park ticket or picking voucher and achieve the safe control effect in preventing the parking vehicle from stealing Meanwhile, it provides the vehicle owner the convenience in combination of cellular phone number as input method as well as promotes the manual management and running efficiency of the parking facility.

Owner:YAN CHEN

Gaming method

ActiveUS7980934B2Reduce advantageImprove casino gamingBoard gamesCard gamesHuman–computer interactionCash payment

A gaming method operates to provide expert card-counting information to some or all participants, in exchange for a premium. The premium may be a cash payment, a reduction in the prize amounts or betting odds, some combination of the foregoing, or any other useful remuneration. The house retains its edge via the premium. The method may be implemented for play at a physical or virtual card table.

Owner:INTELLECTUAL VENTURES I LLC

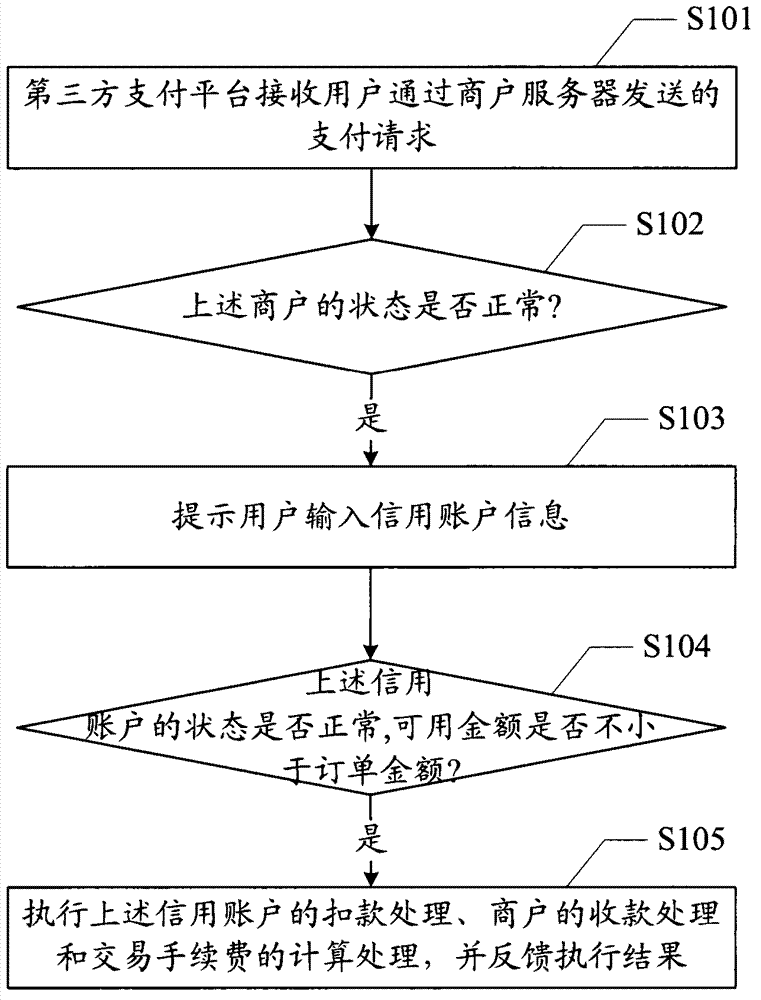

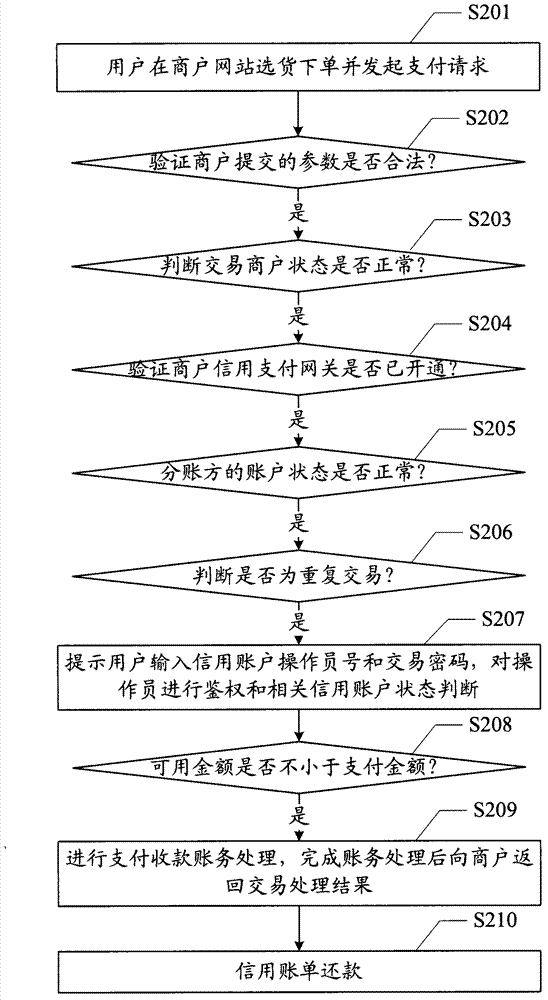

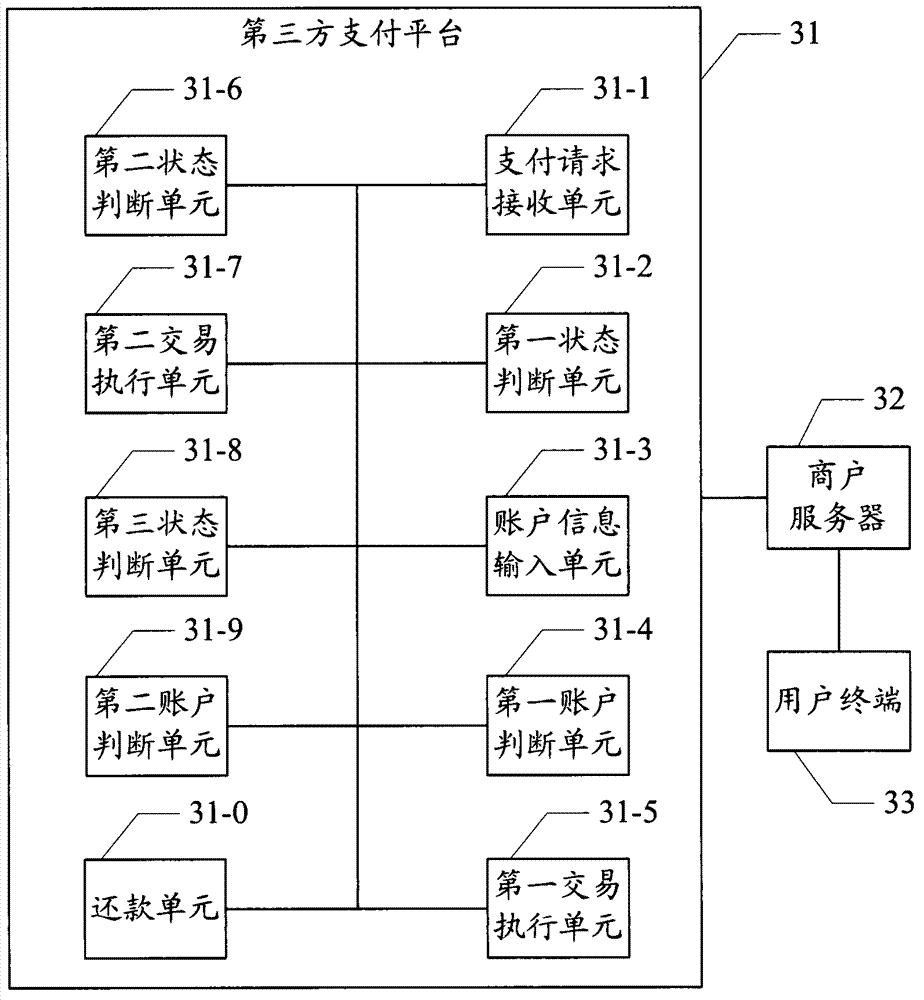

Payment control method and system based on credit data

ActiveCN102968715AImprove turnover efficiencyHigh yieldPayments involving neutral partyThird partyUser input

The invention provides a payment control method and a system based on credit data. The method includes that a third-party payment platform receives payment requests sent by a merchant server; whether the state of a merchant is normal is judged, if the state is normal, a user is prompted to input credit account information, whether the state of a credit account is normal and an available amount is larger than or equal to an order amount are judged, if the state is normal and the available amount is larger than or equal to an order amount, deduction treatment of the credit account, collection treatment of the merchant and calculation treatment of transaction procedure fees are performed. The third-party payment platform provides a credit account with a certain amount and a payment day for users at different merchants respectively according to parameter values of users, in an available amount, users can complete safe network transaction in the condition that actual cash payment is produced without banks, and accordingly, the capital turnover efficiency is accelerated, and fund yields of industry chains are improved.

Owner:汇付天下有限公司

Electronic payment system utilizing intermediary account

InactiveUS8086530B2Complete banking machinesCredit registering devices actuationCredit cardPayment transaction

Payments in cash are submitted to a merchant at a point of sale. The payment transaction is effected electronically to credit the end user's intermediary account. Subsequent electronic communications between the intermediary account and a vendor site effect payment to the vendor for goods or services on behalf of the end user. This system leverages the existing credit card payment system in reverse so as to provide the convenience of submitting cash payments at a multitude of merchant locations.

Owner:PRECASH

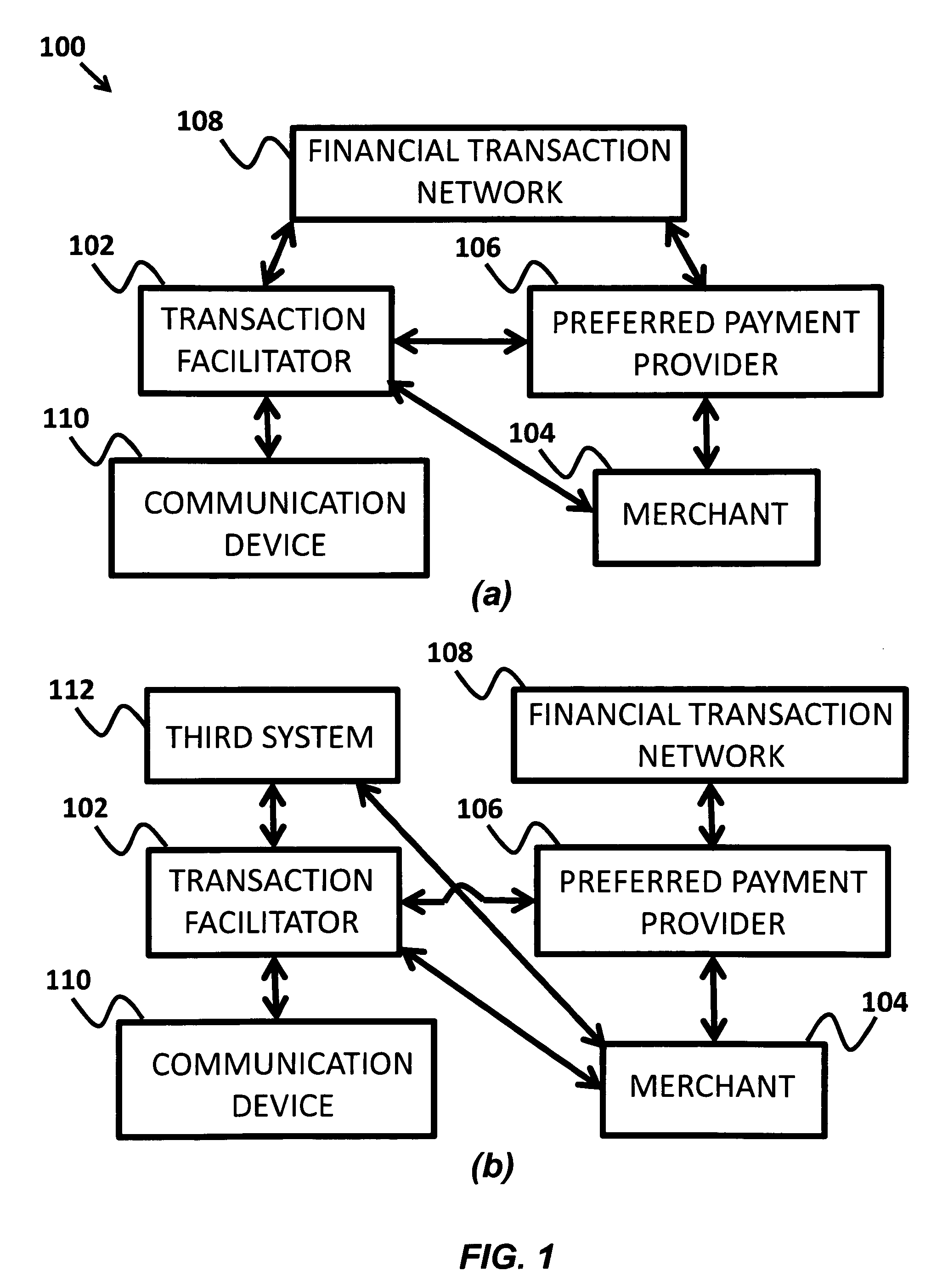

Facilitated mobile transactions

A stand-in payment and transaction facilitator system is provided. A merchant registers their details with a transaction facilitator and is assigned a merchant identifier. When a mobile user transacts with the merchant, the merchant identifier is communicated to the user's mobile device. At the payment step, the transaction facilitator uses the merchant's details referenced by their identifier to complete the payment portion of the transaction using any non-cash payment mechanism or service of the users choosing. The transaction facilitator offers for-purchase items from the merchants. The merchants use preferred payment providers. Communication devices are used to select for-purchase items from the transaction facilitator. The transaction facilitator communicates payment information received from the communication device to a financial transaction network for payment in the transaction to purchase the for-purchase item. On payment approval, the transaction facilitator communicates payment approval and a selected for-purchase item list to the merchant.

Owner:TAYLOR WILLIAM STUART ERVIN

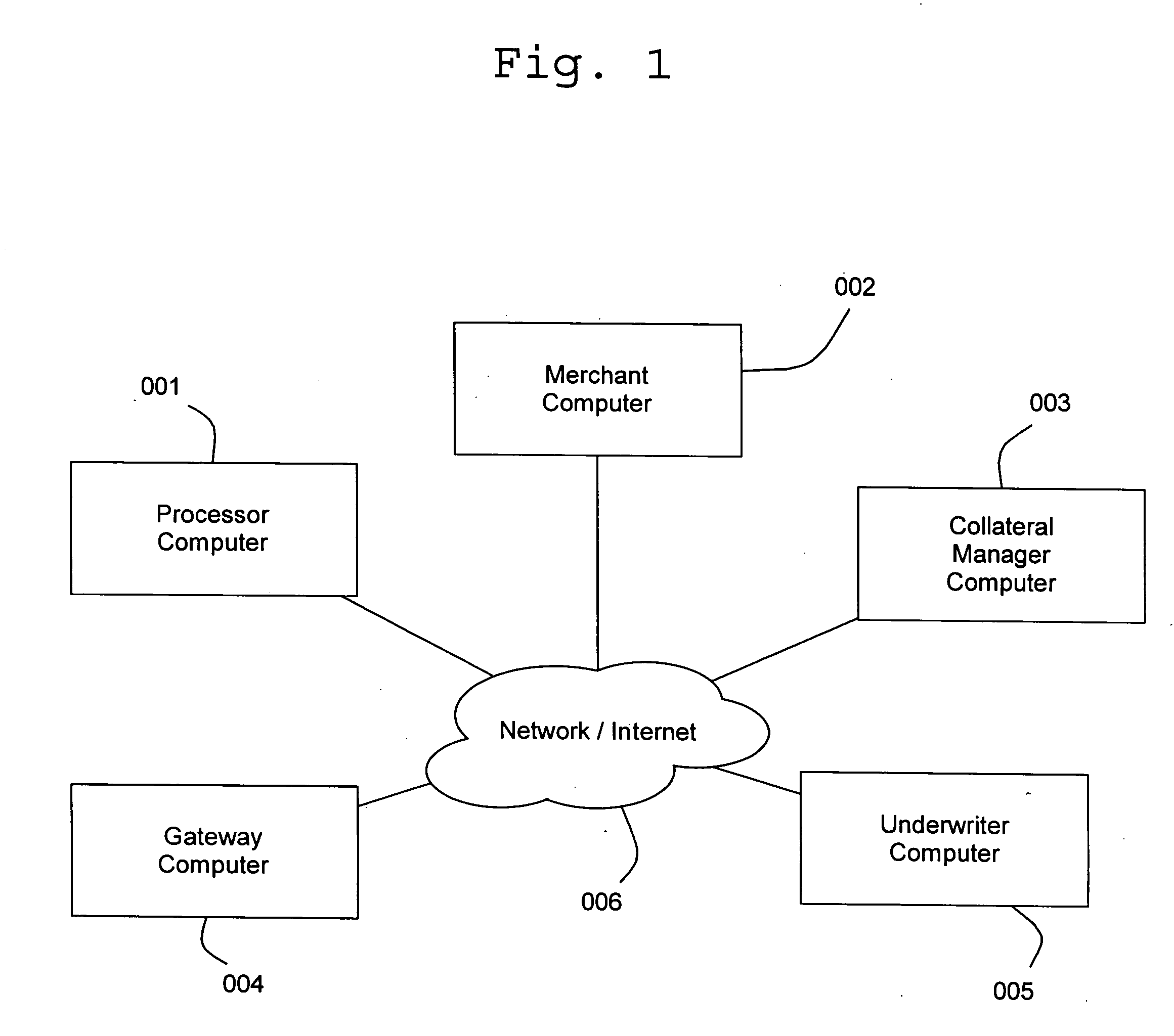

System and method for underwriting payment processing risk

InactiveUS20050256747A1Easy to participateSpread riskFinanceMarketingPayment transactionFinancial transaction

A method, using a computer system, for underwriting the risk of non-payment associated with processing non-cash payments on behalf of a merchant by managing balances in pledged collateral accounts owned by one or a plurality of underwriters. The invention determines the initial amount of required collateral, in total and for each participating underwriter, as a function of estimated sales and recalculates required collateral, as payment transactions and other transactions affecting collateral accounts occur. In the event of an anticipated underwriter collateral shortfall, the underwriter is notified that a collateral increase is required. Payment processing is suspended if collateral shortfall is imminent.

Owner:HELLRIGEL ROBERT MICHAEL

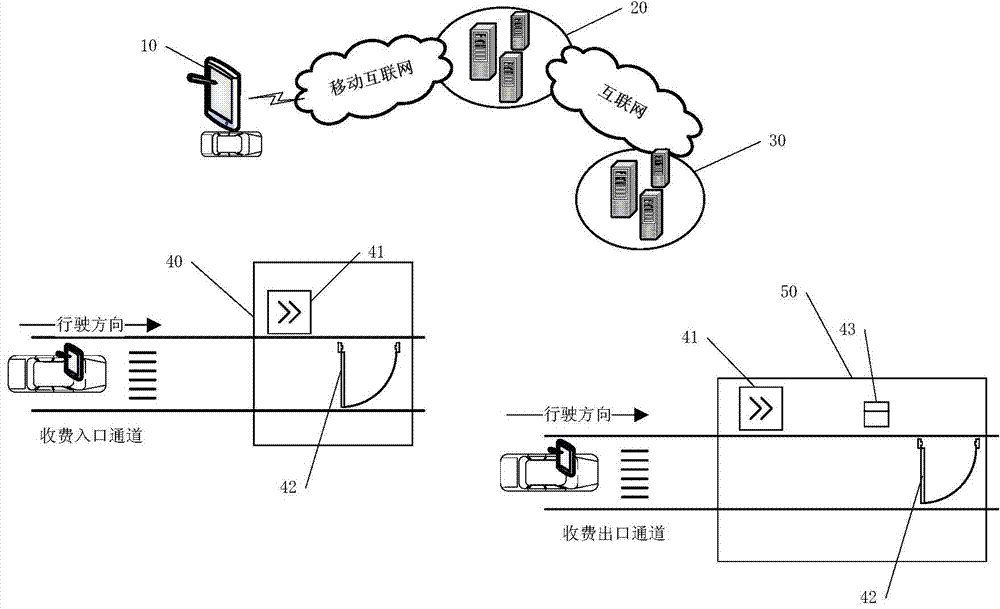

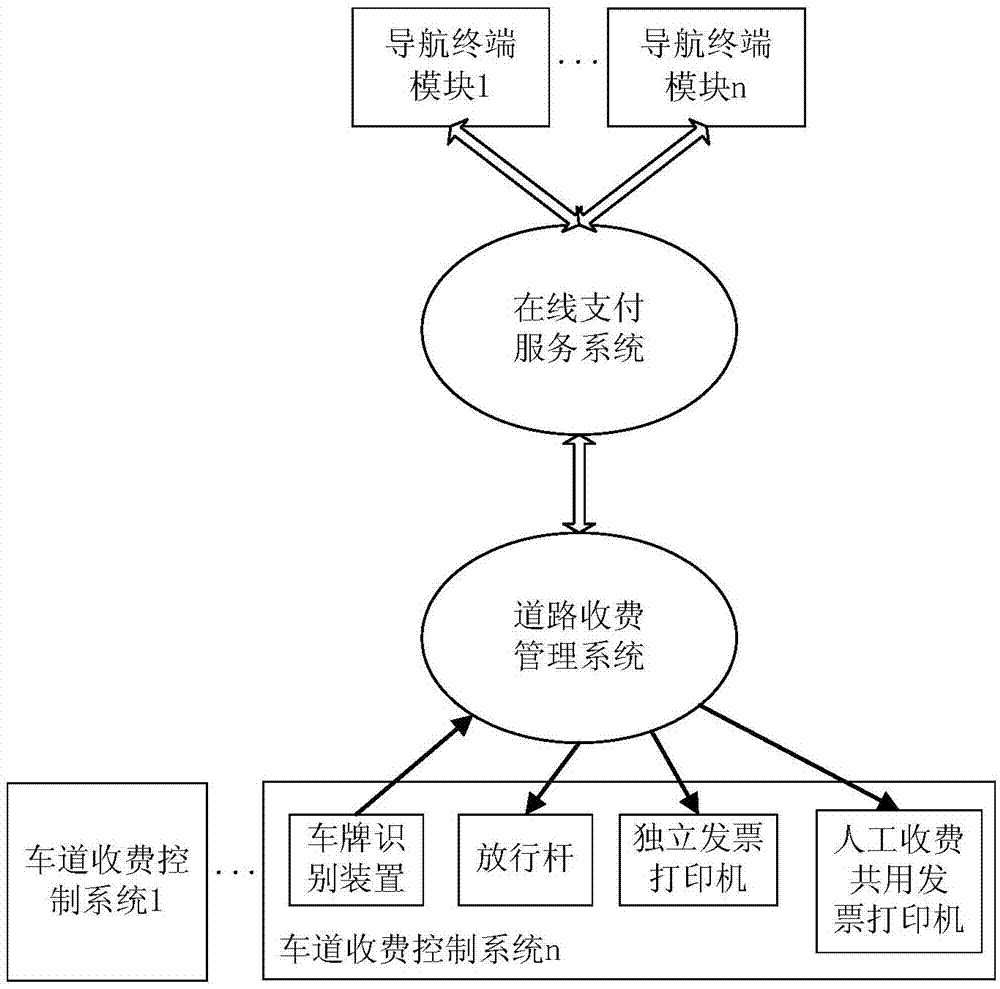

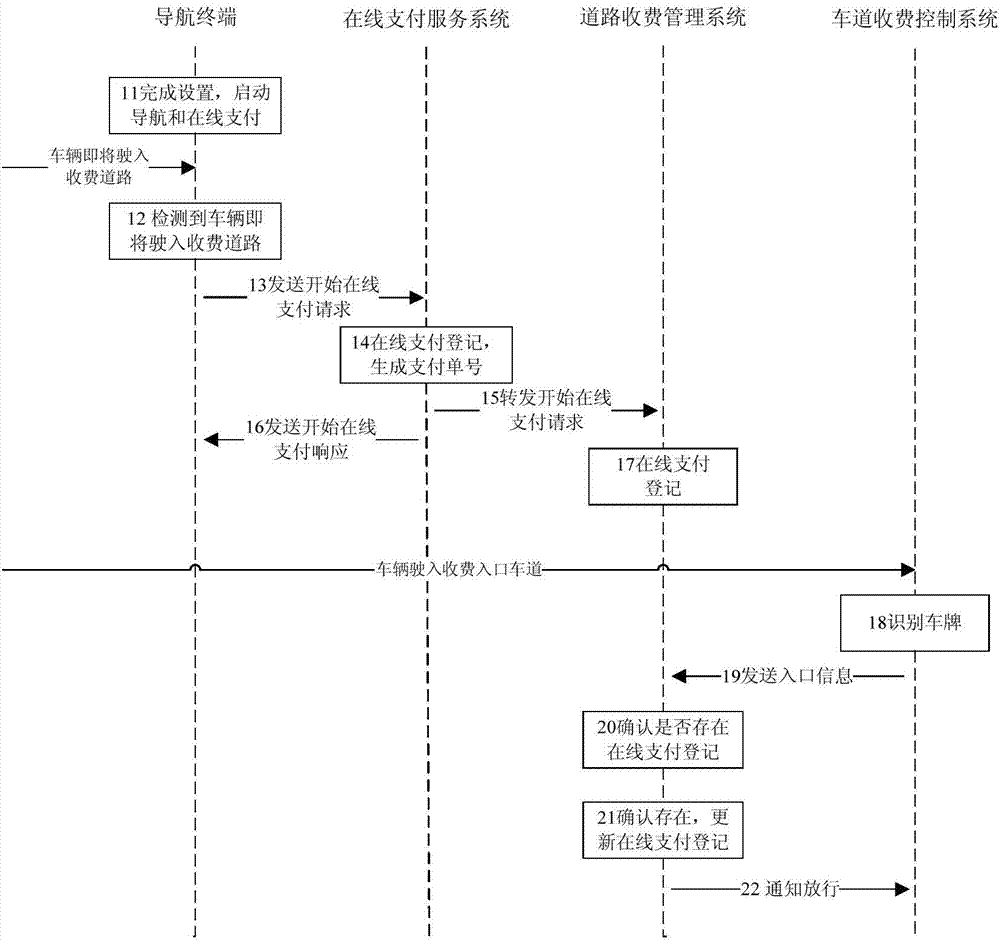

Quick charging system and method for toll road

The invention discloses a quick charging system and method for a toll road. The quick charging system for the toll road comprises a navigation payment terminal, an online payment service system, a road charge management system and a lane charge control system. The quick charging method for the toll road mainly comprises an online payment request starting process and an online payment request executing process. The quick charging system and method for the toll road use the online payment mode of the navigation payment terminal to replace the time-consuming cash payment link of the current manual charging mode to realize the fast pass of vehicles in the toll lane; the quick charging system can use the existing base facilities of the toll lane in common so as to facilitate the system implementation and application; as more and more people use the online payment means, the quick charging system and method for the toll road are more convenient to attract more users to use the payment means of the quick charging system and method for the toll road.

Owner:邬学农

Pension alternative retirement income system

An improved method of funding and delivering benefits to the retired participants of a defined benefit pension plan. The method does this by having the plan purchase cash value life insurance with respect to each retired plan participant, and then entering into separate agreement(s) with institutional third parties to exchange a portion of the future death benefits from those policies for periodic cash payments that could be used to make pension benefit payments to plan participants as they become due. Such modified funding and delivery mechanism could result in significant cost savings to the defined benefit plan as it may be able to deliver more benefits per dollar of contribution to plan assets, thereby improving the financial health and prospects of the defined benefit plan, while also offering sufficient profit potential to other third parties to induce them to play a necessary role in the funding and delivery of plan benefits.

Owner:MASSACHUSETTS MUTUAL LIFE INSURANCE COMPANY

Non-Cash Cash-on-Delivery Method and System

The present invention provides a method and system for non-cash cash-on-delivery. In the conventional process of the cash-on-delivery in logistics, a wireless communication apparatus is provided to read the information of the identification docket number and a non-cash payment tool, and the information is transported to the logistics server so as to accomplish the mechanism of the collecting-and-paying for another with a financial institution.

Owner:TAIWAN PELICAN EXPRESS

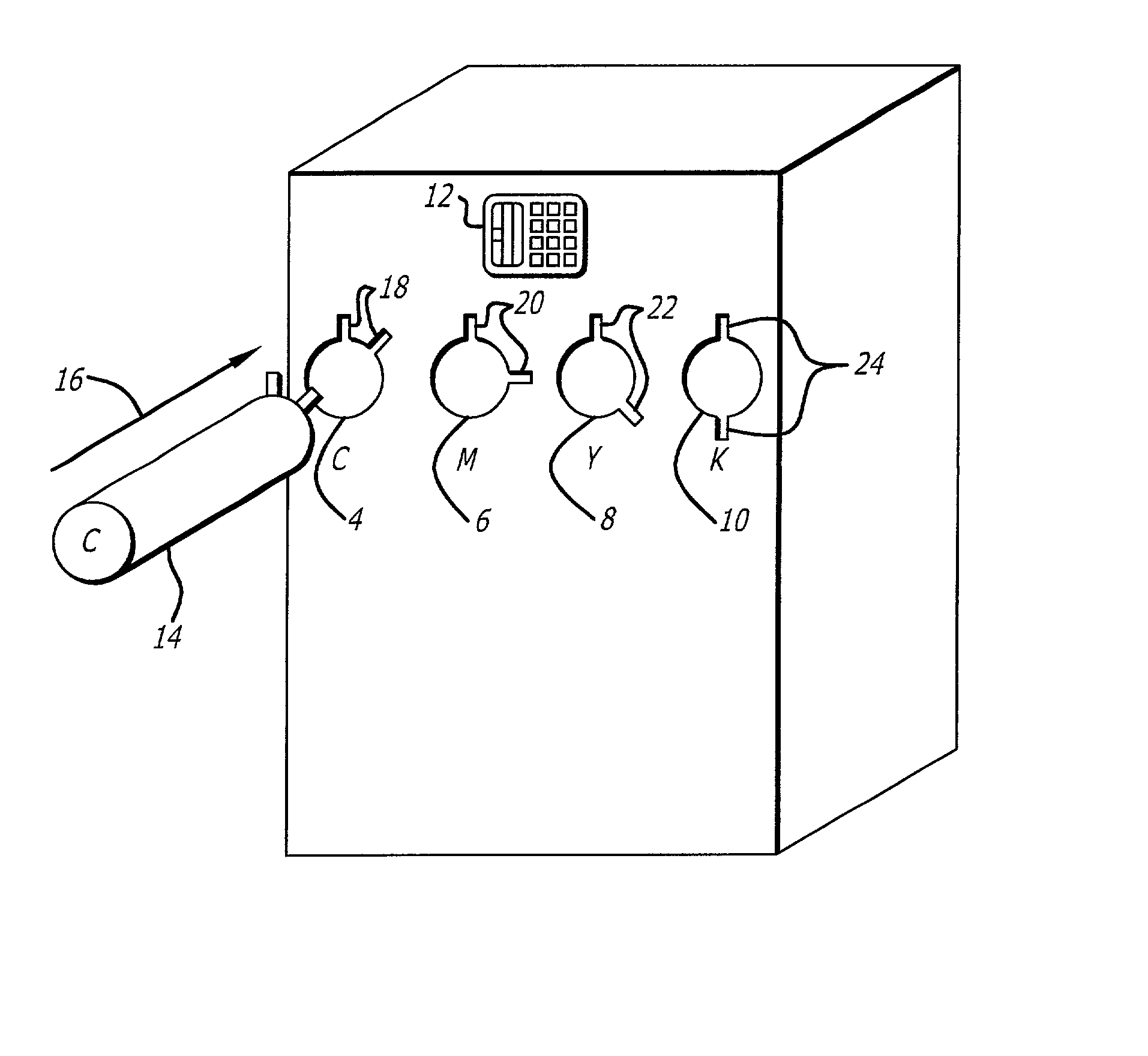

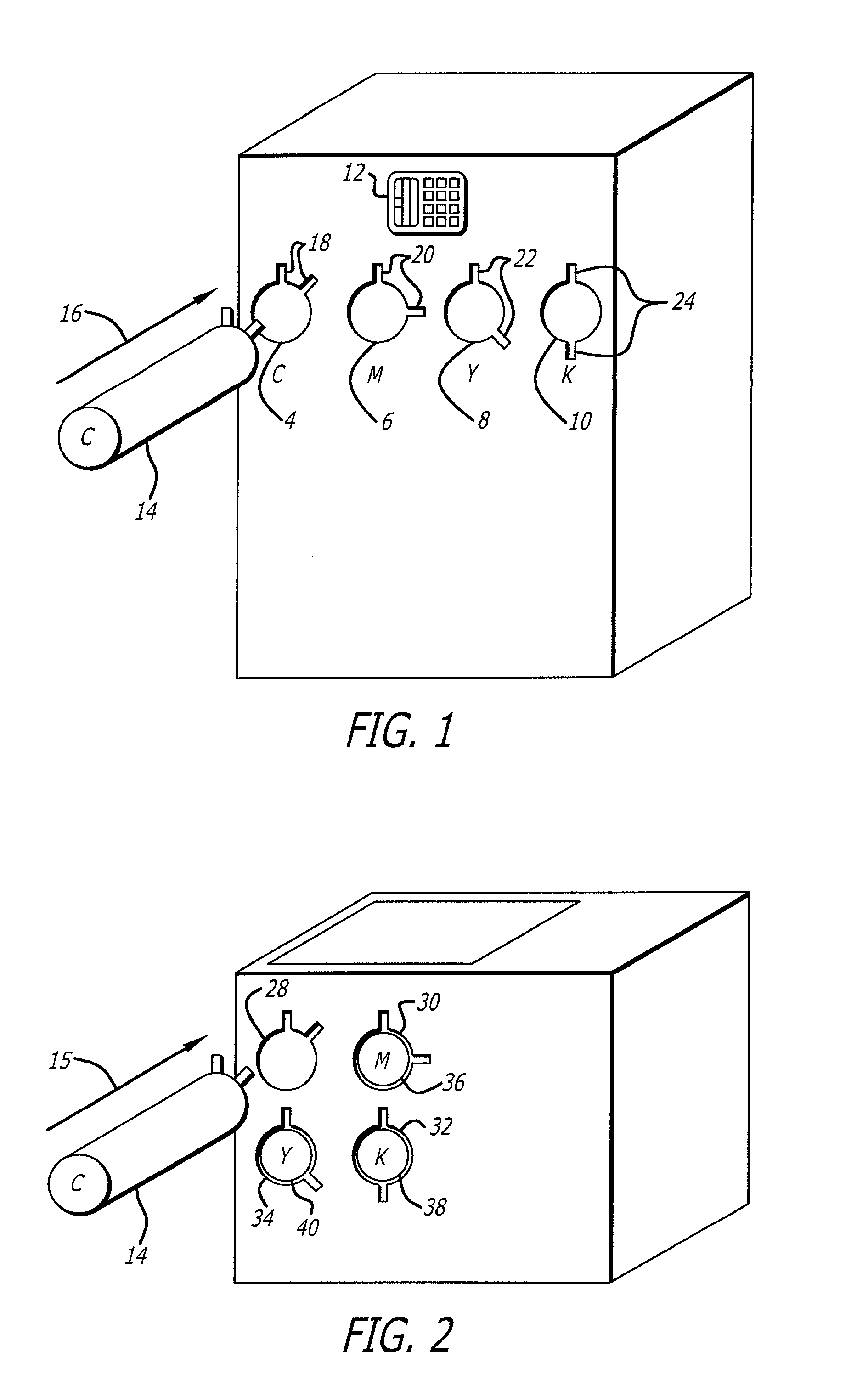

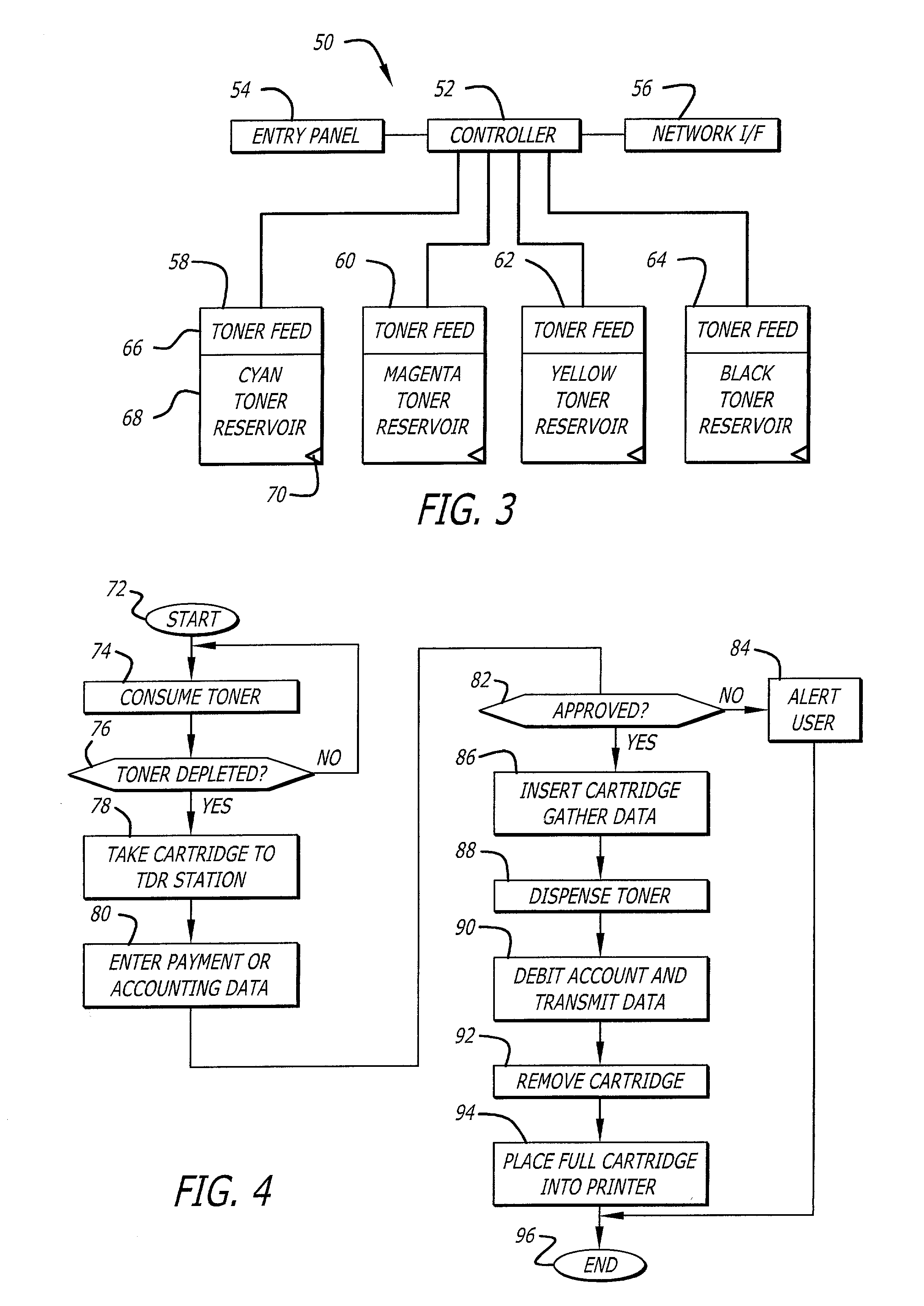

Printing cartridge pigment replenishment apparatus and method

InactiveUS20030184624A1Electrographic process apparatusOther printing apparatusCredit cardInk printer

An apparatus and method for refilling pigment cartridges. The apparatus includes a device for engaging a pigment cartridge and a pigment reservoir. A pigment transfer device, having an enabling input, is coupled to convey pigment from the pigment reservoir to the device for engaging a pigment cartridge upon activation of the enabling input. The apparatus also includes an accounting device coupled to the enabling input, such that the accounting device activates the enabling input upon receiving an account stimulus, and, thereby effects a transfer of pigment from the pigment reservoir to the pigment cartridge. In illustrative embodiments the pigment is toner or ink for laser printers and inkjet printer respectively. The accounting stimulus may be approval for a credit card transaction, a cost accounting systems, or may be cash payment.

Owner:HEWLETT PACKARD DEV CO LP

Intelligent commodity settlement system and method based on visual recognition and weight sensing technologies

PendingCN108537994ARealize identificationRealize automatic weighingCharacter and pattern recognitionCash registersTime efficientVisual recognition

The invention relates to an intelligent commodity settlement system and method based on visual recognition and weight sensing technologies. A settlement counter of the intelligent commodity settlementsystem includes a local data processing unit, a camera, a weight sensing assembly, a biological information acquisition module, a touch display screen, a remote server and a voice module, wherein thecamera, the weight sensing assembly, the biological information acquisition module, the touch display and the voice module are connected with the local data processing unit; and the local data processing unit 1 also establishes a communication connection through a wired or wireless network. The intelligent commodity settlement method includes the successive steps: registration of users, acquisition of commodity image data and weight data, and settlement for users. The intelligent commodity settlement system and method based on visual recognition and weight sensing technologies have the advantages of saving time and labor, reducing the equipment and operating cost, and solving the problem that the current retailer is inconvenient in the cash payment link.

Owner:DEEPBLUE TECH (SHANGHAI) CO LTD

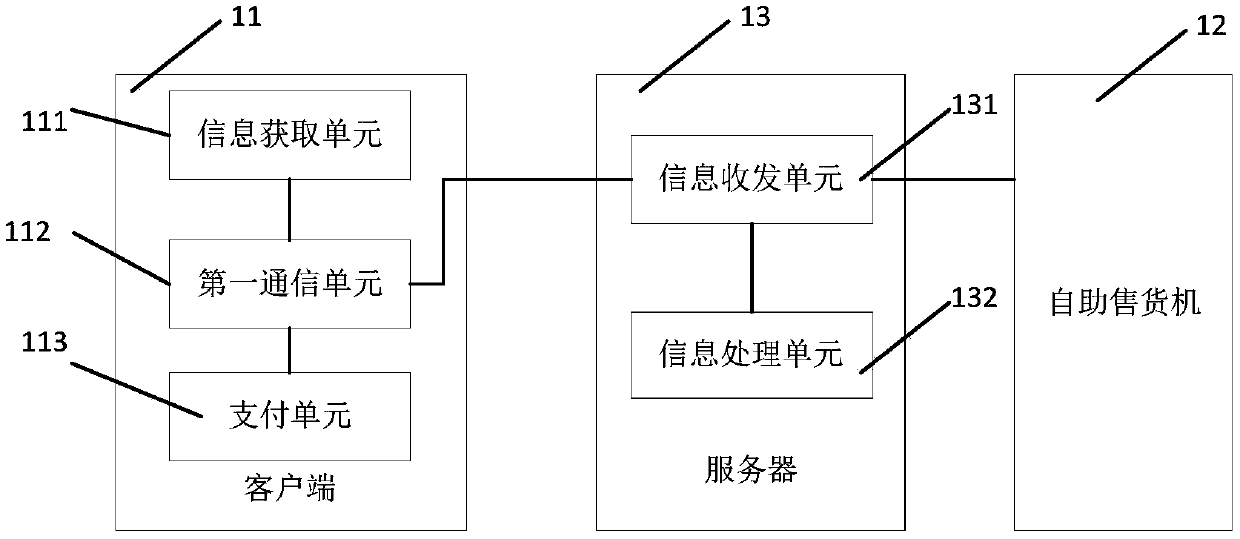

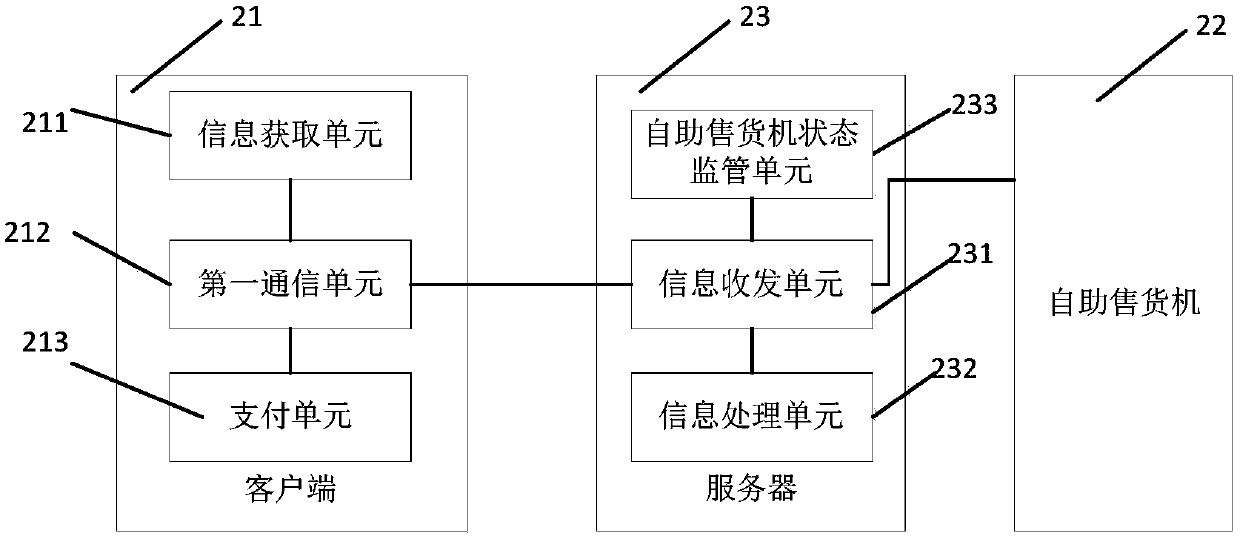

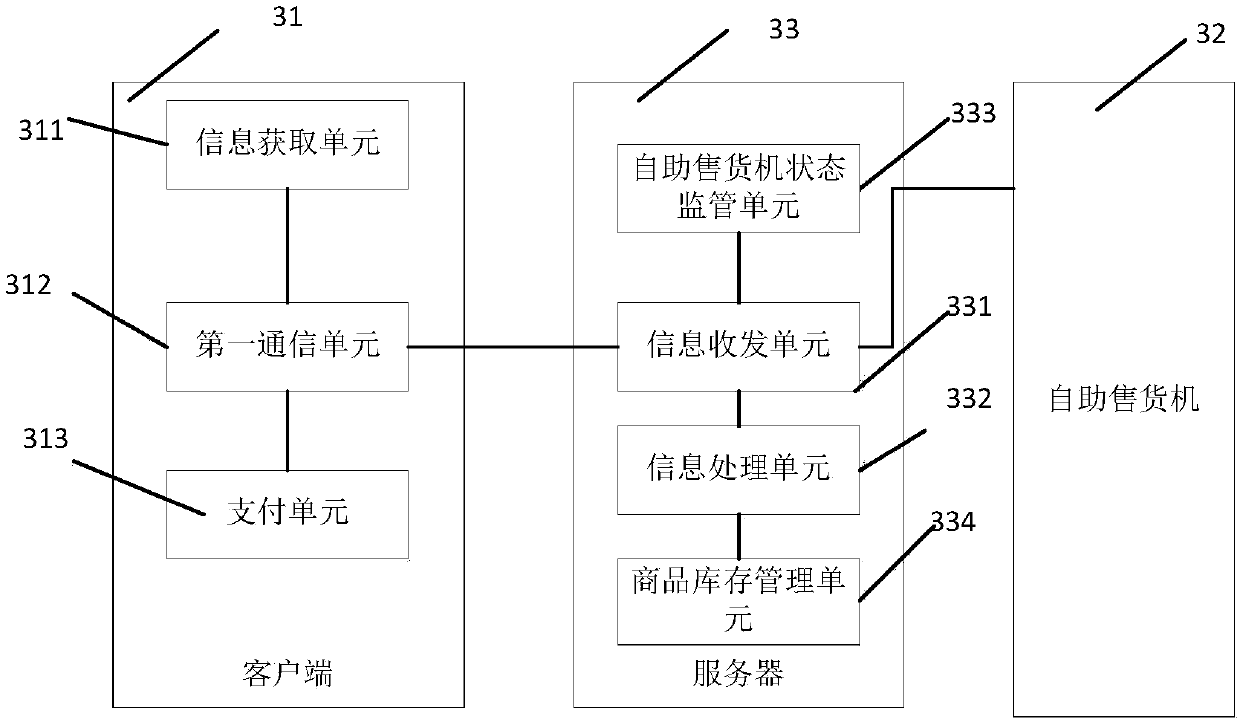

Intelligent self-help vending system

InactiveCN107730725ASimple internal structureLow costCoin-freed apparatus detailsPayment architectureInformation processingCommunication unit

The invention discloses an intelligent self-help vending system and relates to the technical field of self-help vending equipment. The system comprises a client side, a self-help vending machine and aserver, the client side comprises an information acquiring unit, a first communication unit and a payment unit, the server comprises an information transceiving unit and an information processing unit, and the self-help vending machine receives a control order sent by the server and executes commodity selection, commodity conveying and commodity outgoing. Commodity purchase and order payment areperformed through the client side, a payment system does not need to be arranged on the self-help vending machine, and cash payment is not needed, so that inside structure of the self-help vending machine is simplified, configuration of the self-help vending machine is improved, production cost of the self-help vending machine is lowered, operating cost is lowered, and operating profit is increased.

Owner:胡启凡 +1

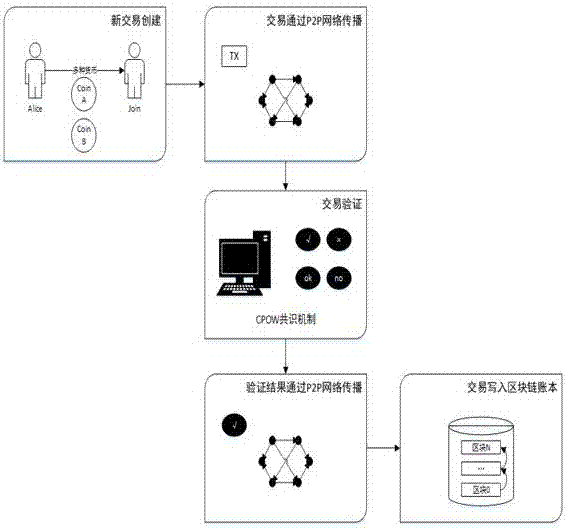

Establishing method of electronic wallet based on block chain

InactiveCN107369010ASolve the ceiling problemResolve trust issuesPayment protocolsPayment circuitsCredit systemValue passing

The invention discloses an establishing method of an electronic wallet based on a block chain. The method comprises steps of 1) establishing a new transaction and issuing various types of assets; 2) carrying out the transaction and broadcasting transaction lists to the whole network through a P2 network; 3) carrying out transaction verification; 4) verifying results and broadcasting transaction results to the whole network after the transaction is finished; and 5) writing the transaction results into a block of a block chain. According to the invention, by use of the distributed account book technology, the digital asset flows and real cash payment on the block chain are connected, so in the global Internet market, the function of high-efficiency and low cost value delivery that the traditional financial mechanism cannot replace can be developed; a block chain credit system from the information to the value network is formed; the cryptography packet of each person can be developed into a 'self-finance' platform; and payment, depositing, transferring, exchange, loans and the bookkeeping and clearing in the whole network of the P2P can be achieved.

Owner:兰考同心互联数据管理有限公司

Cash payment apparatus, system and method

InactiveUS20130041776A1Buying/selling/leasing transactionsPoint-of-sale network systemsLibrary scienceCash payment

Using communications enabled devices or computers, Cash Payment System (CPS) buyers authenticate and authorize payment to sellers. Sellers identify themselves to the buyer and the buyer controls the payment process.

Owner:SCHUNEMANN ROBERT PETER

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com