Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

260 results about "Insurance life" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Group life insurance (also known as wholesale life insurance or institutional life insurance) is term insurance covering a group of people, usually employees of a company, members of a union or association, or members of a pension or superannuation fund.

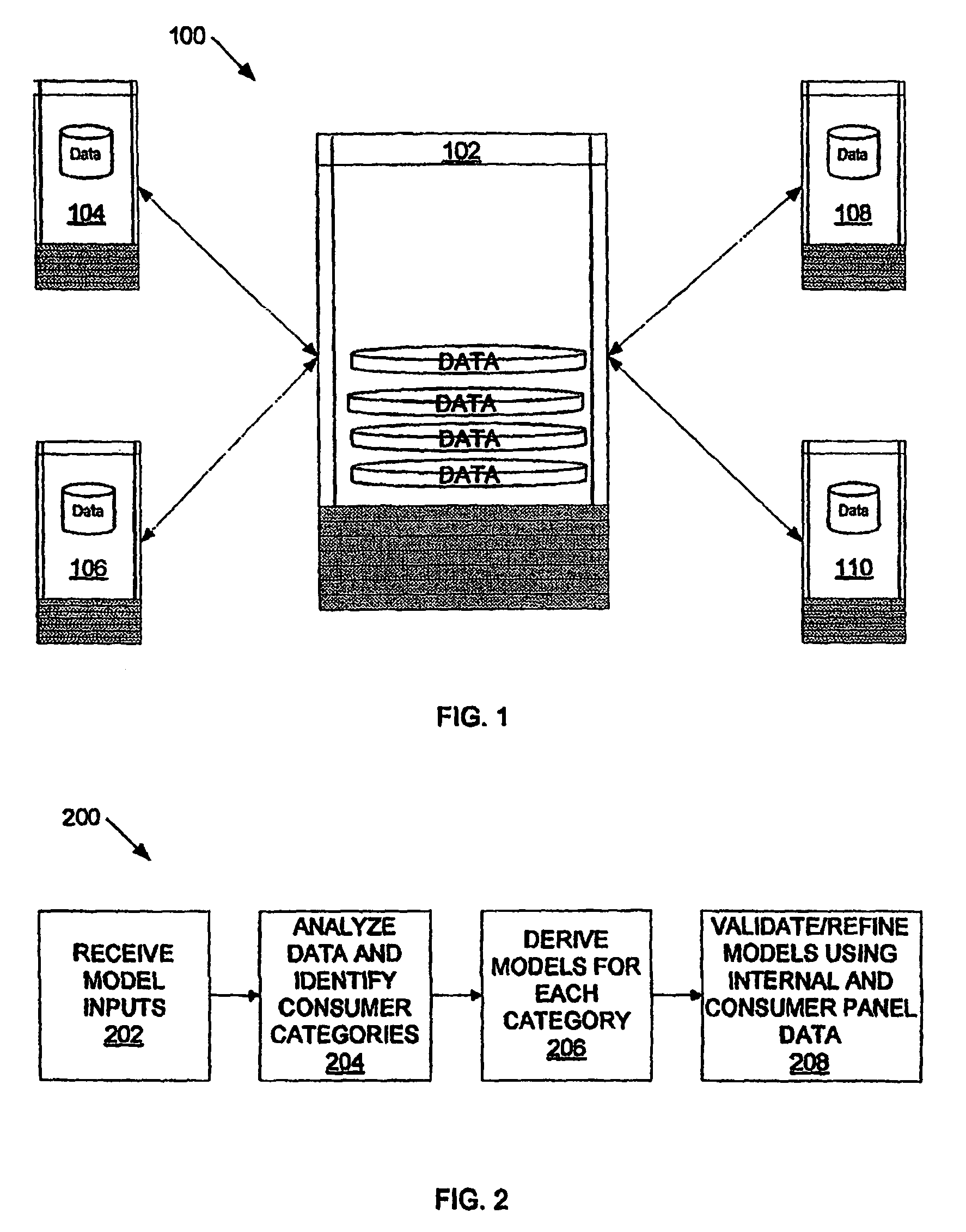

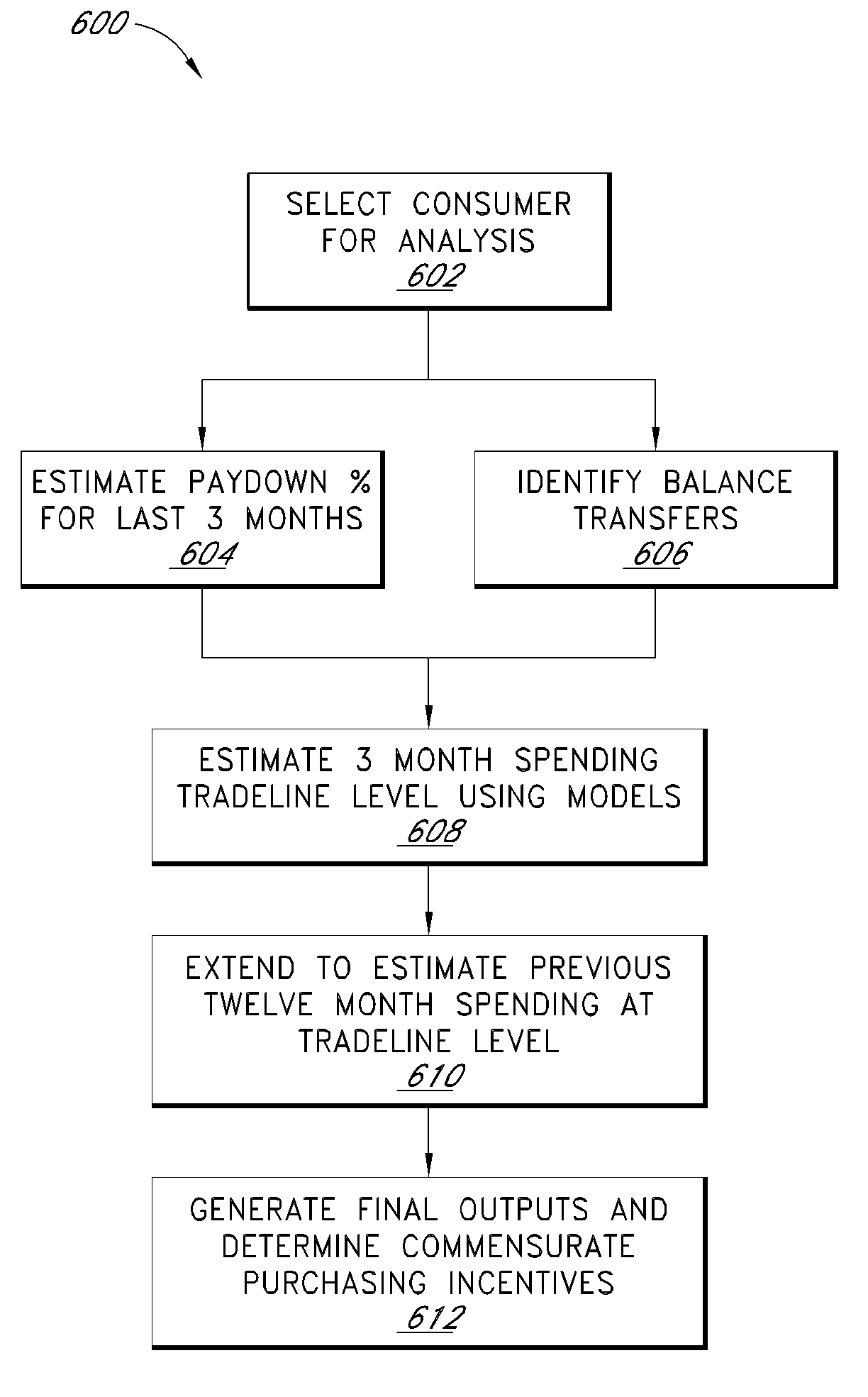

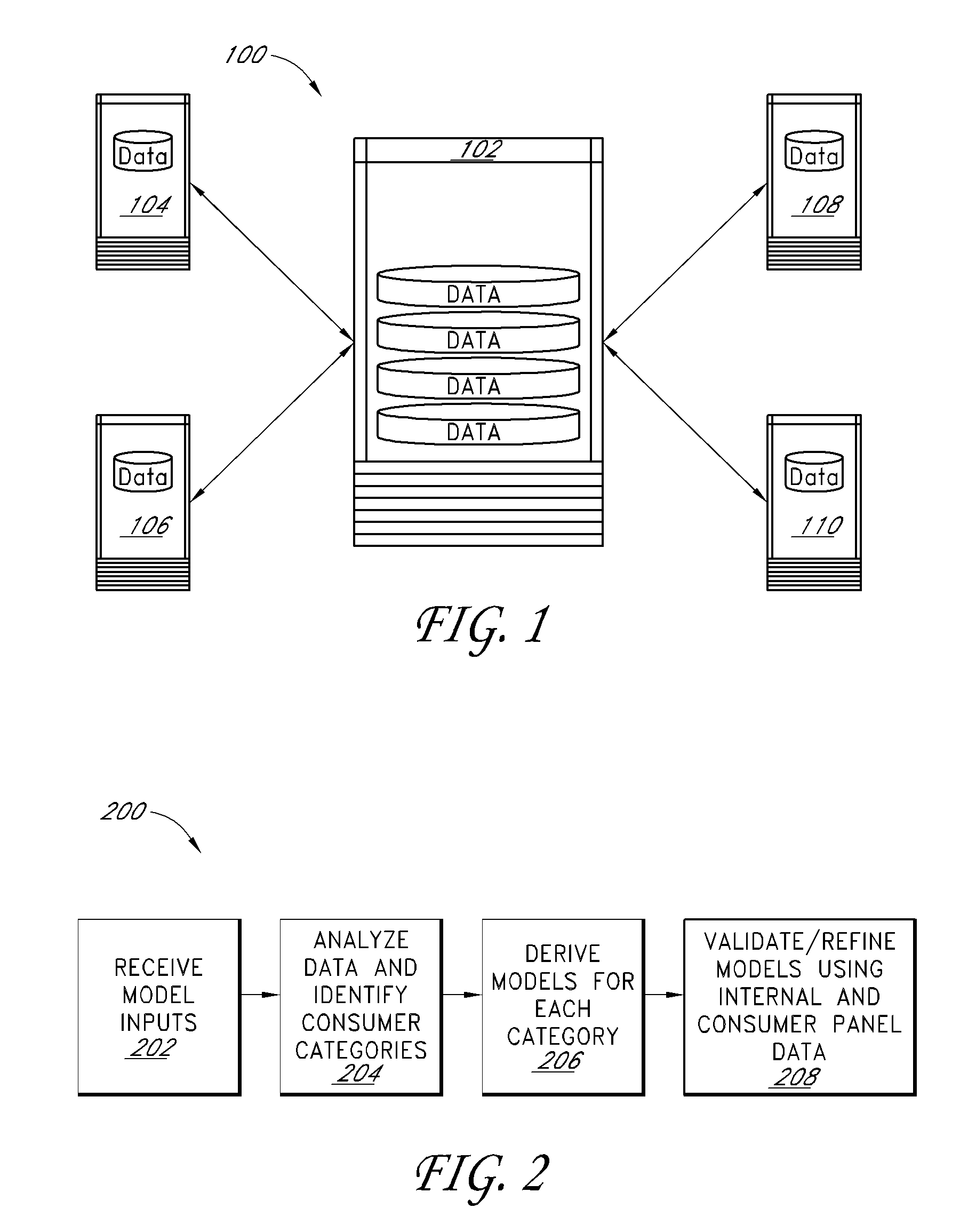

Method and apparatus for consumer interaction based on spend capacity

ActiveUS20060242046A1Efficient use ofEfficient managementFinancePayment architectureBalance transferInsurance life

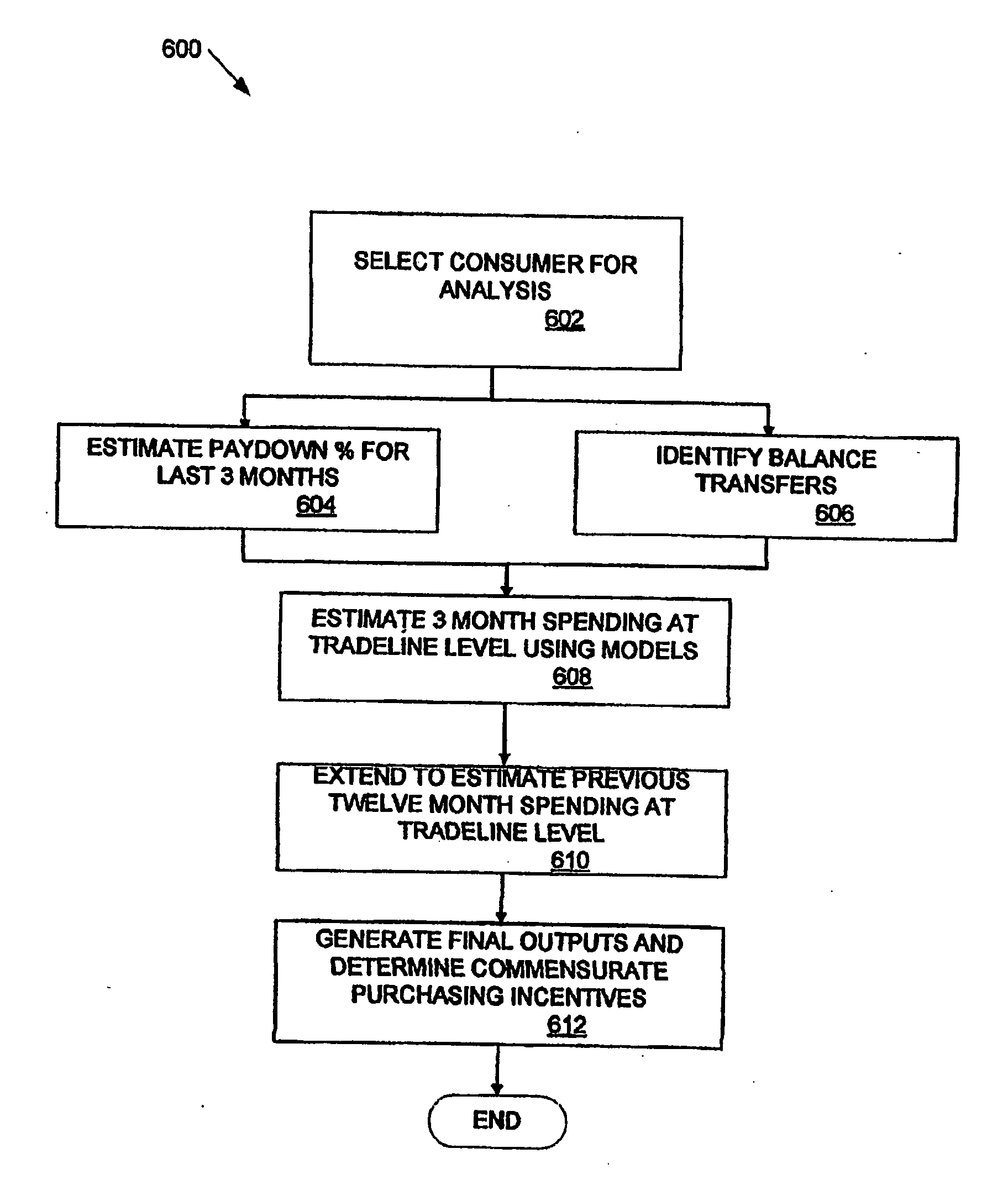

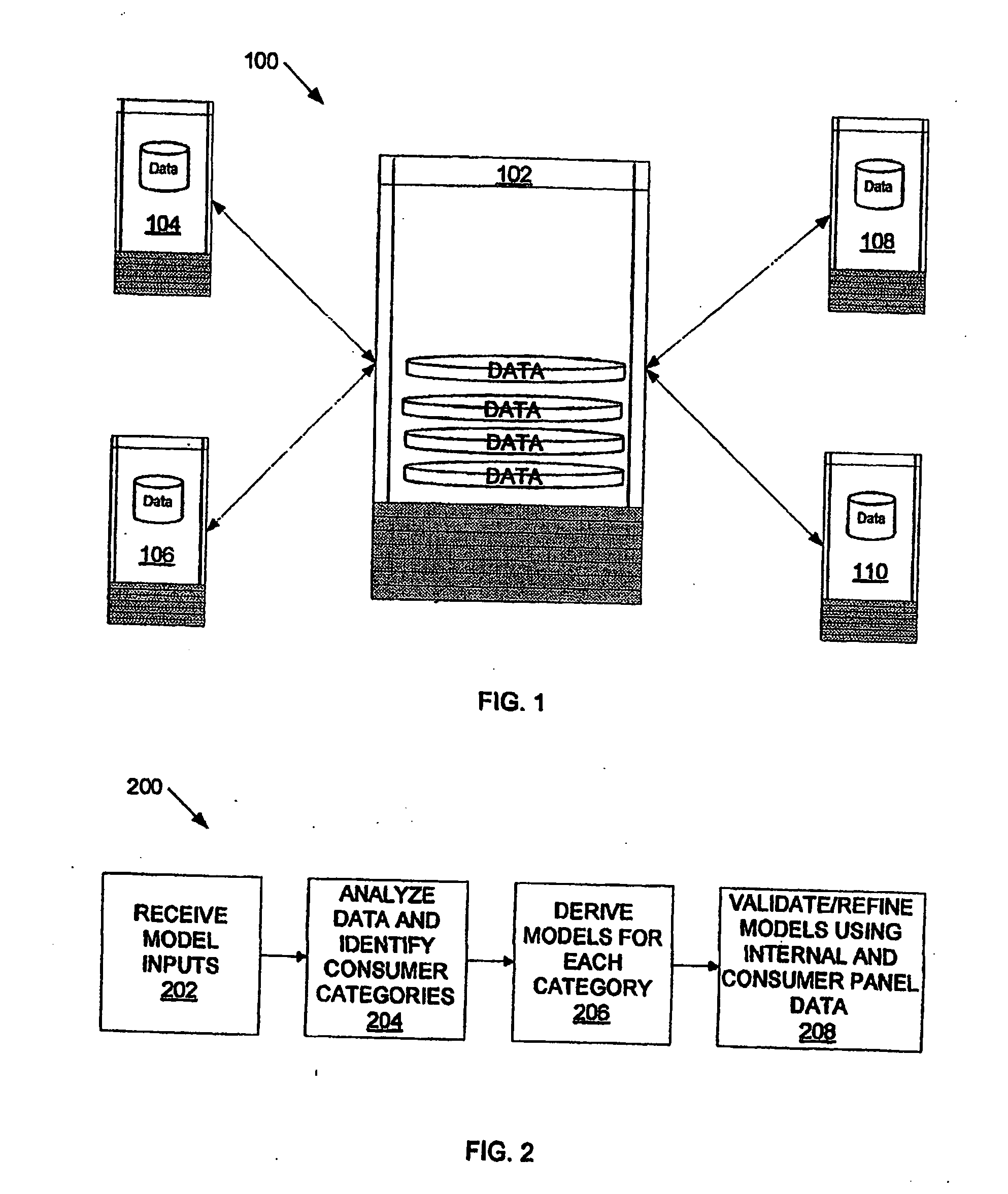

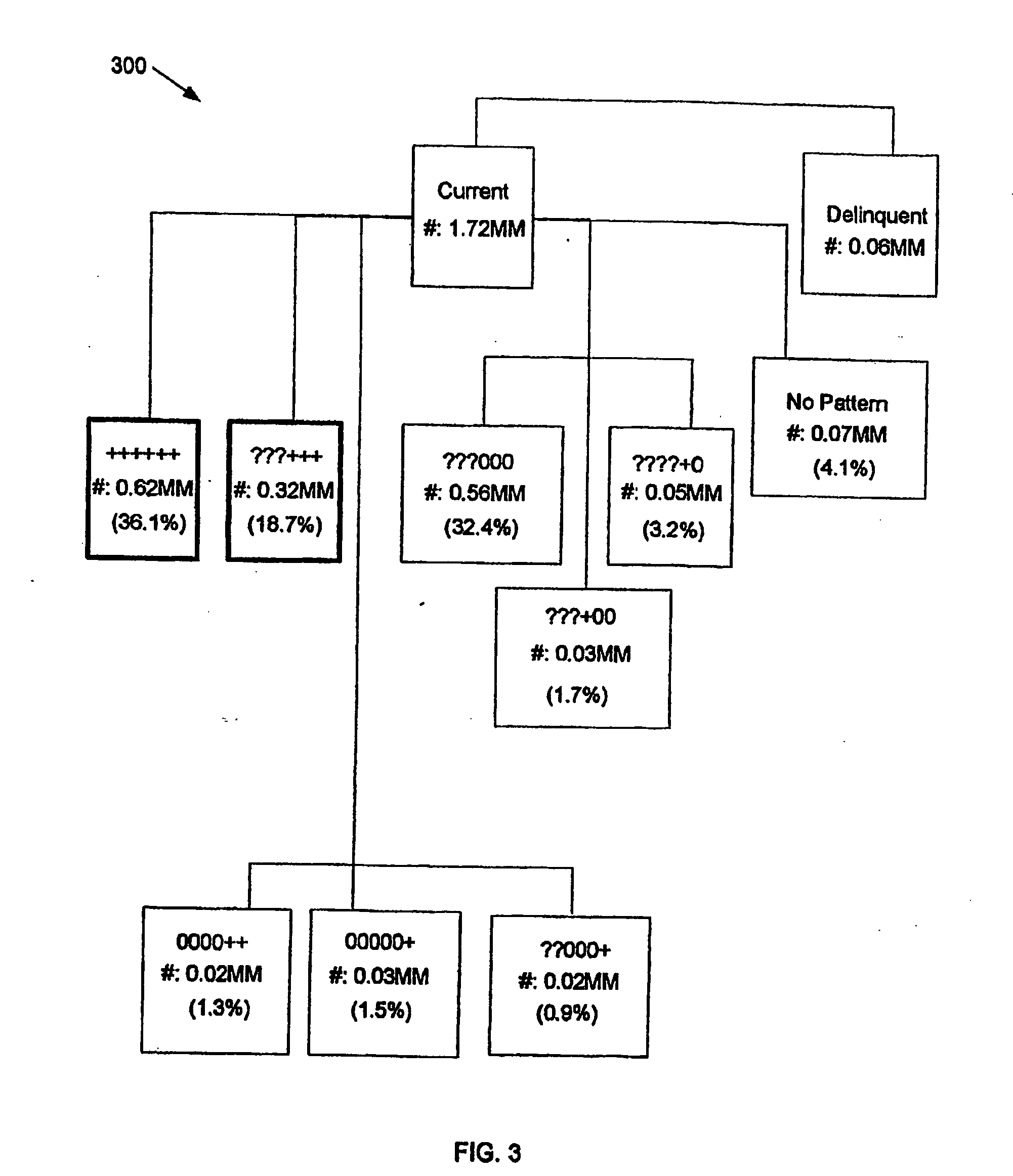

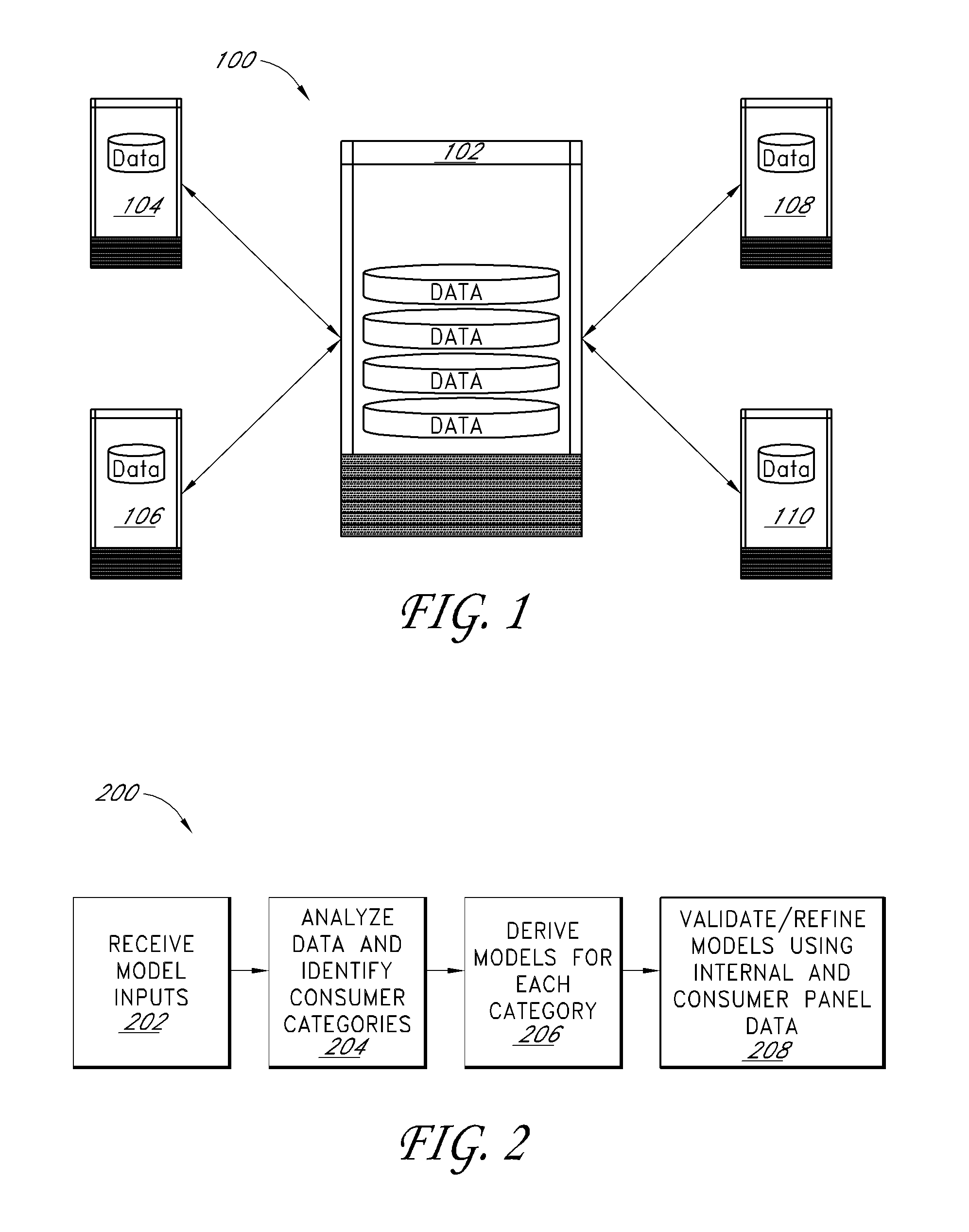

Share of Wallet (“SoW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumer's spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. In addition to credit card companies, SoW outputs may be useful to companies issuing, for example: private label cards, life insurance, on-line brokerages, mutual funds, car sales / leases, hospitals, and home equity lines of credit or loans. “Best customer” models can correlate SoW outputs with various customer groups. A SoW score focusing on a consumer's spending capacity can be used in the same manner as a credit bureau score.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

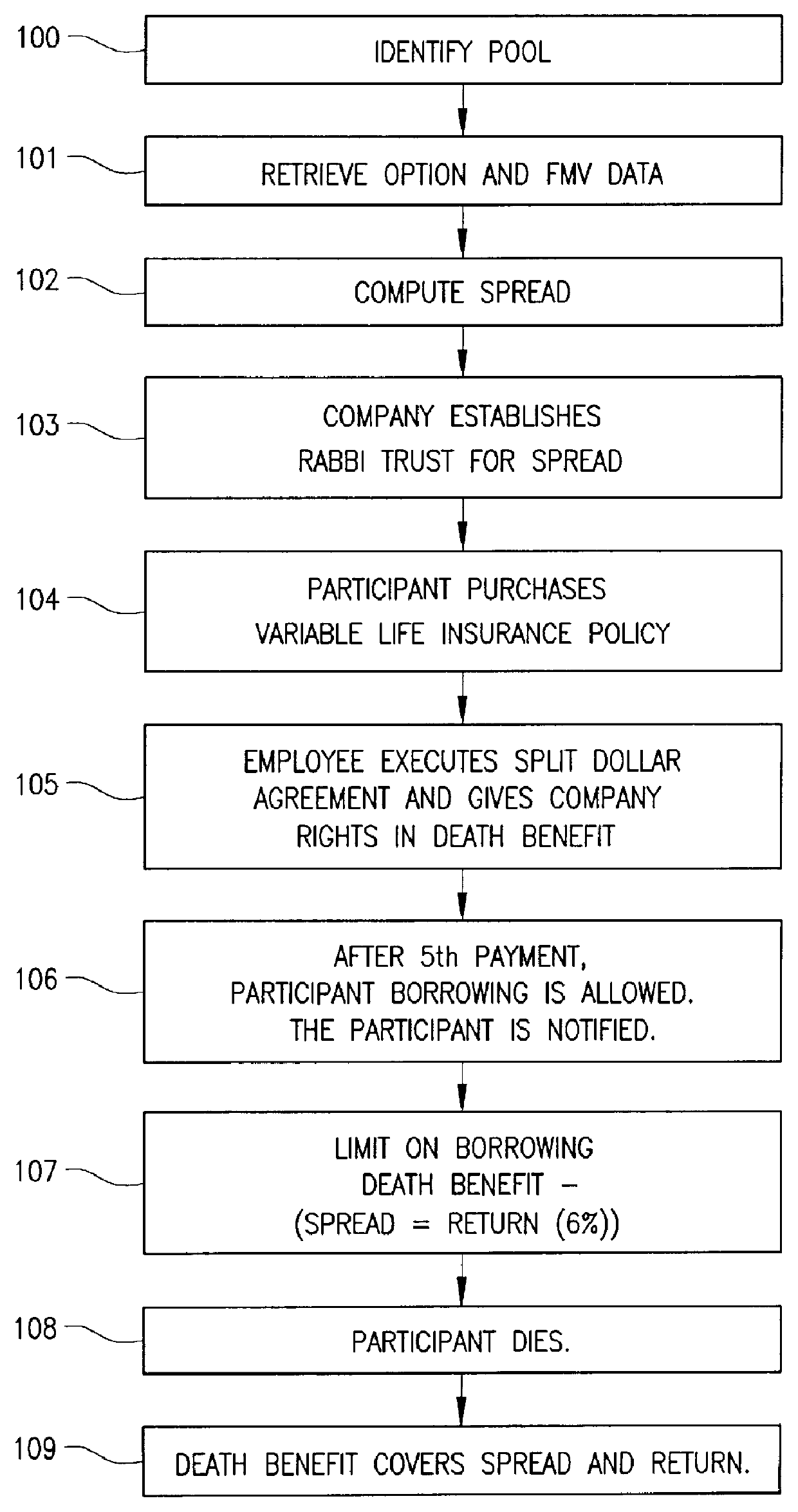

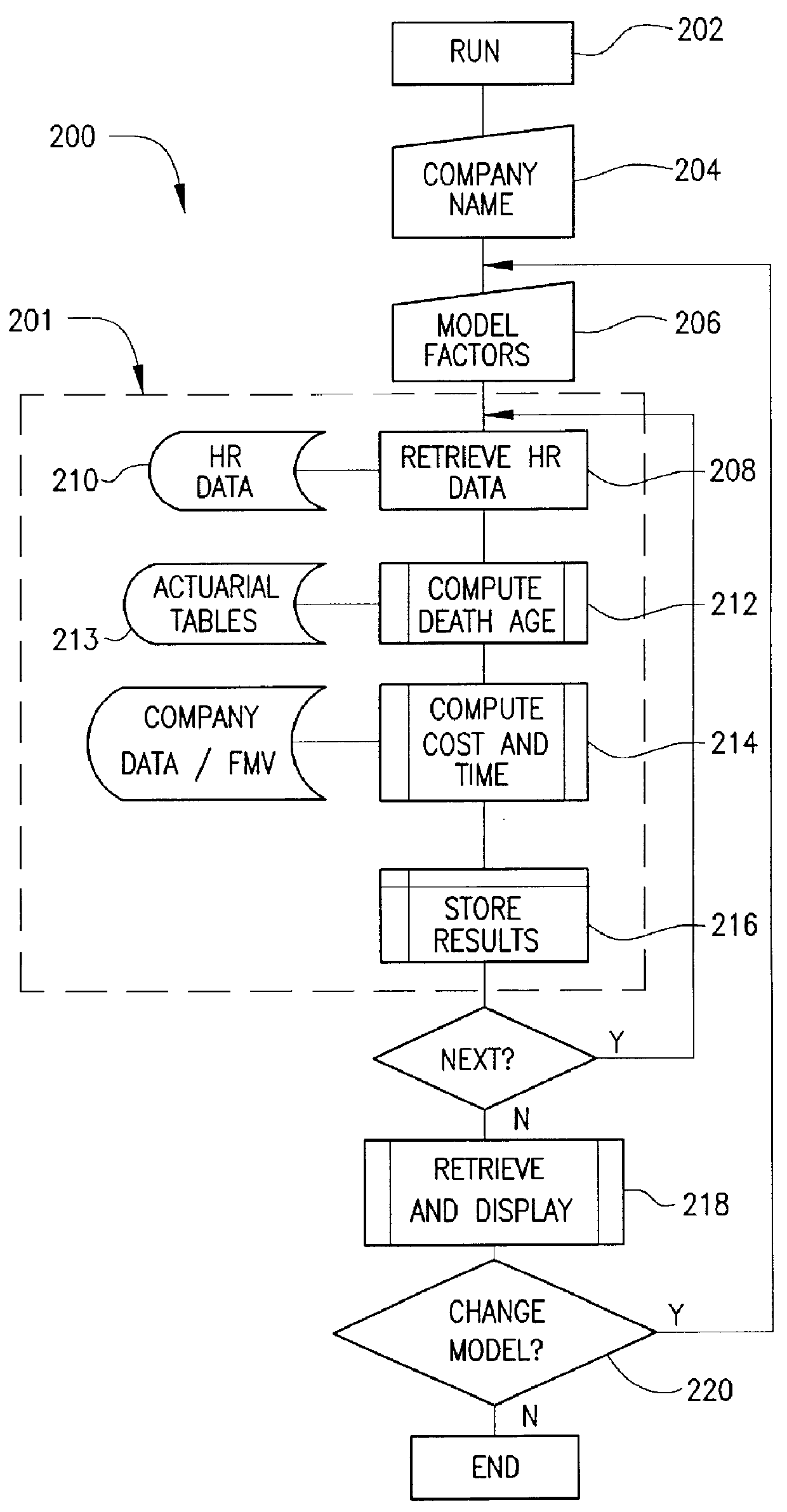

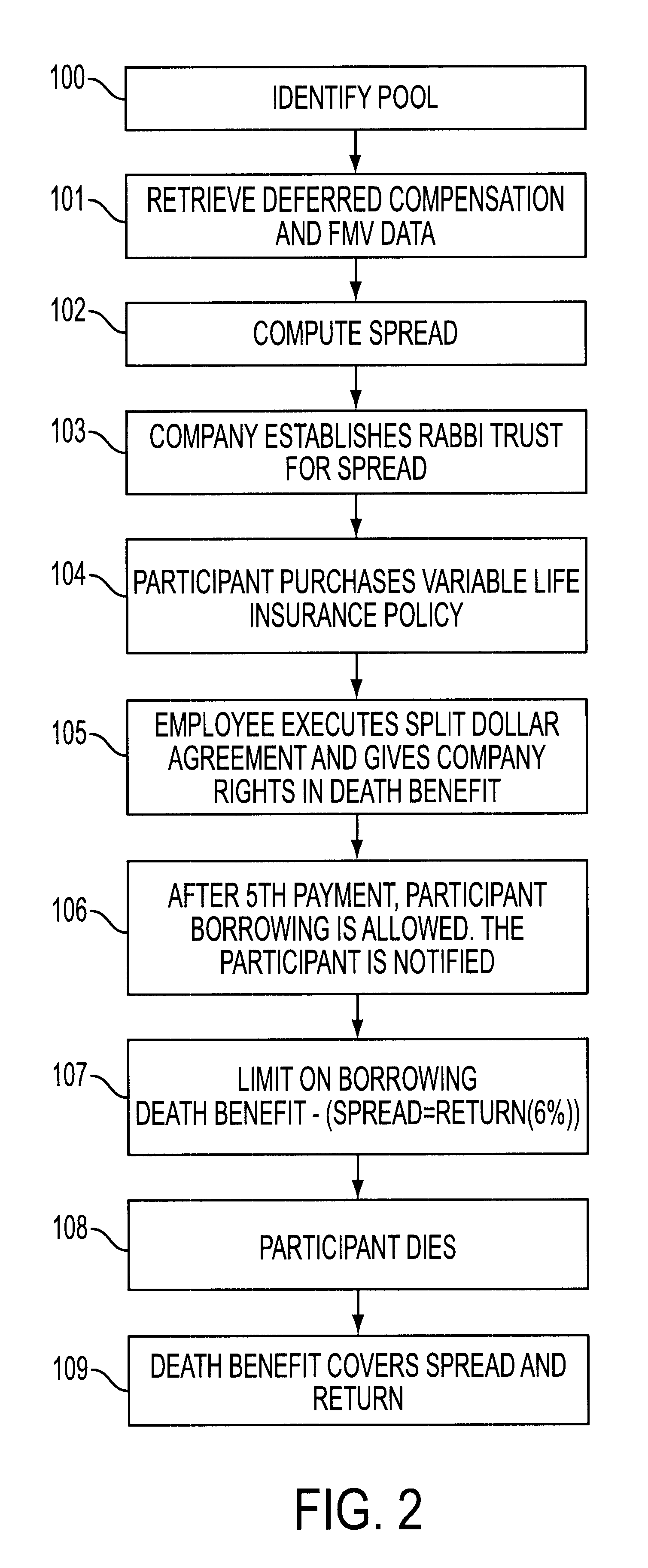

Method and apparatus for modeling and executing deferred award instrument plan

A method and apparatus for deferred award instrument plan by identifying at least one participant in the deferred award plan, retrieving financial data related to stock options corresponding to the identified participant, computing a spread associated with the retrieved stock options, establishing a rabbi trust with the spread, determining whether a life insurance policy has been purchased by the participant, determining whether a split dollar agreement has been executed, monitoring and paying at least one premium for the life insurance policy and notifying the participants that a payment associated with the life insurance policy has been paid.

Owner:ASCENSUS INSURANCE SERVICES

Method and apparatus for consumer interaction based on spend capacity

InactiveUS20080228556A1Efficient use ofEfficient managementFinanceSpecial data processing applicationsBalance transferInsurance life

Owner:EXPERIAN MARKETING SOLUTIONS

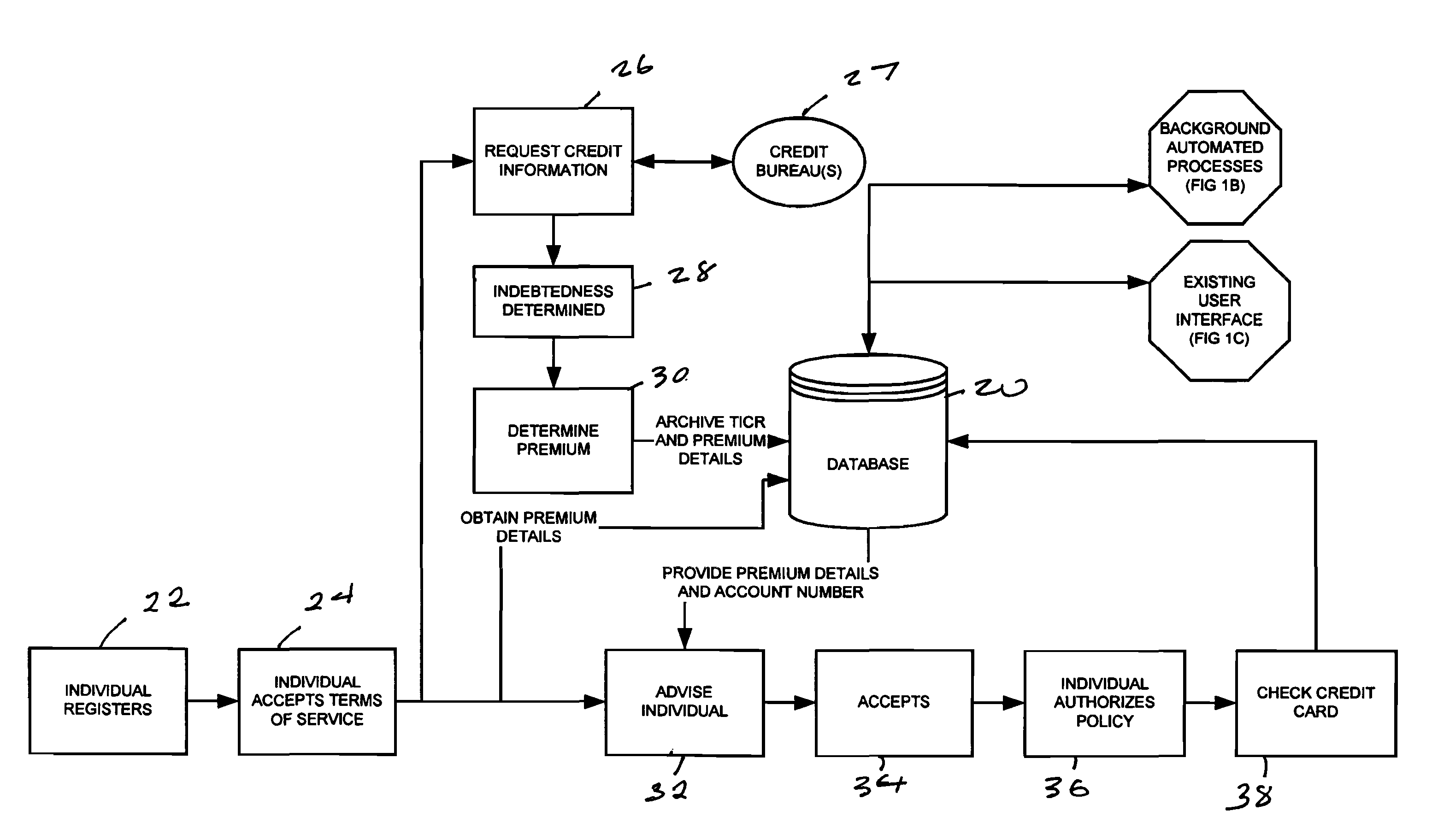

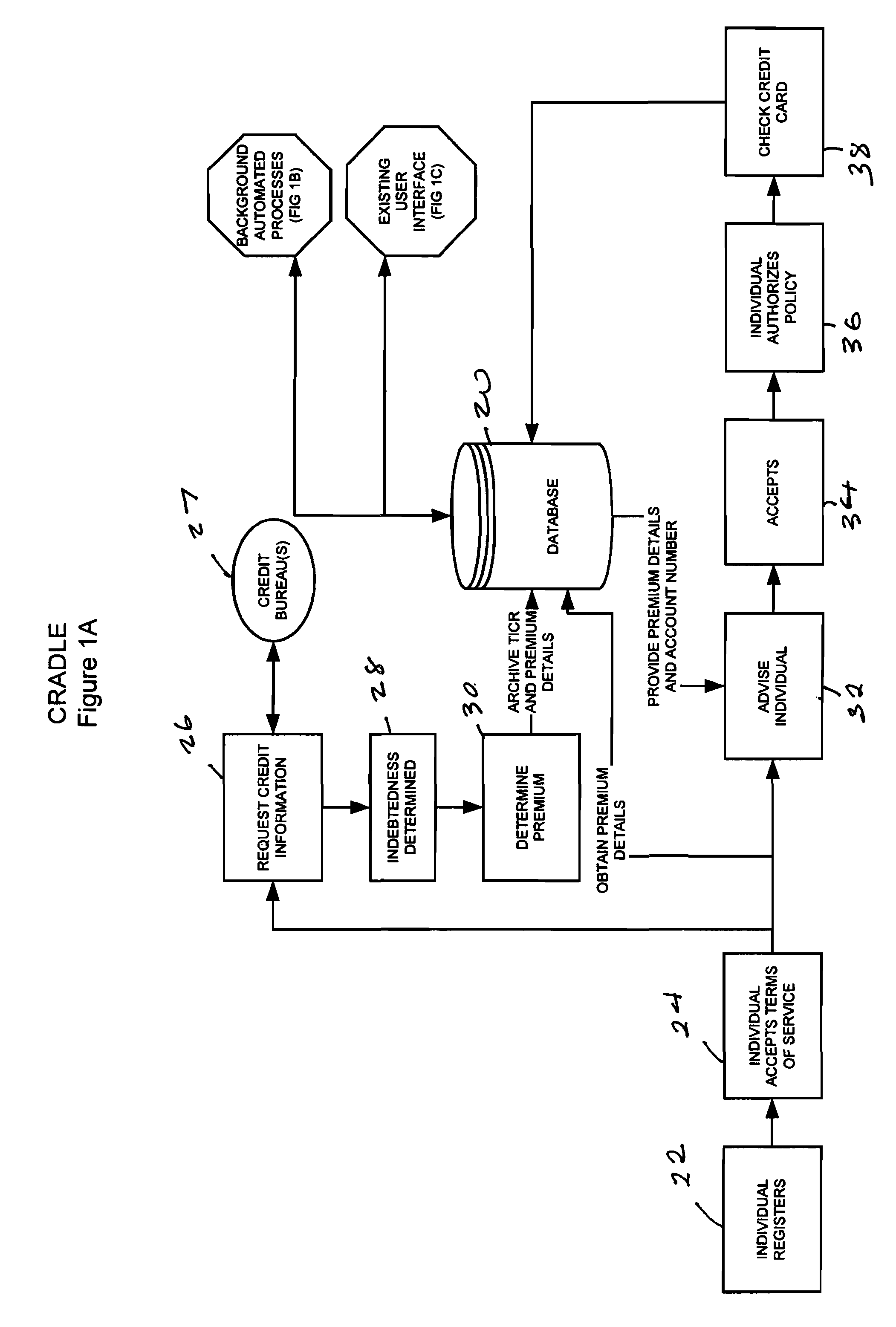

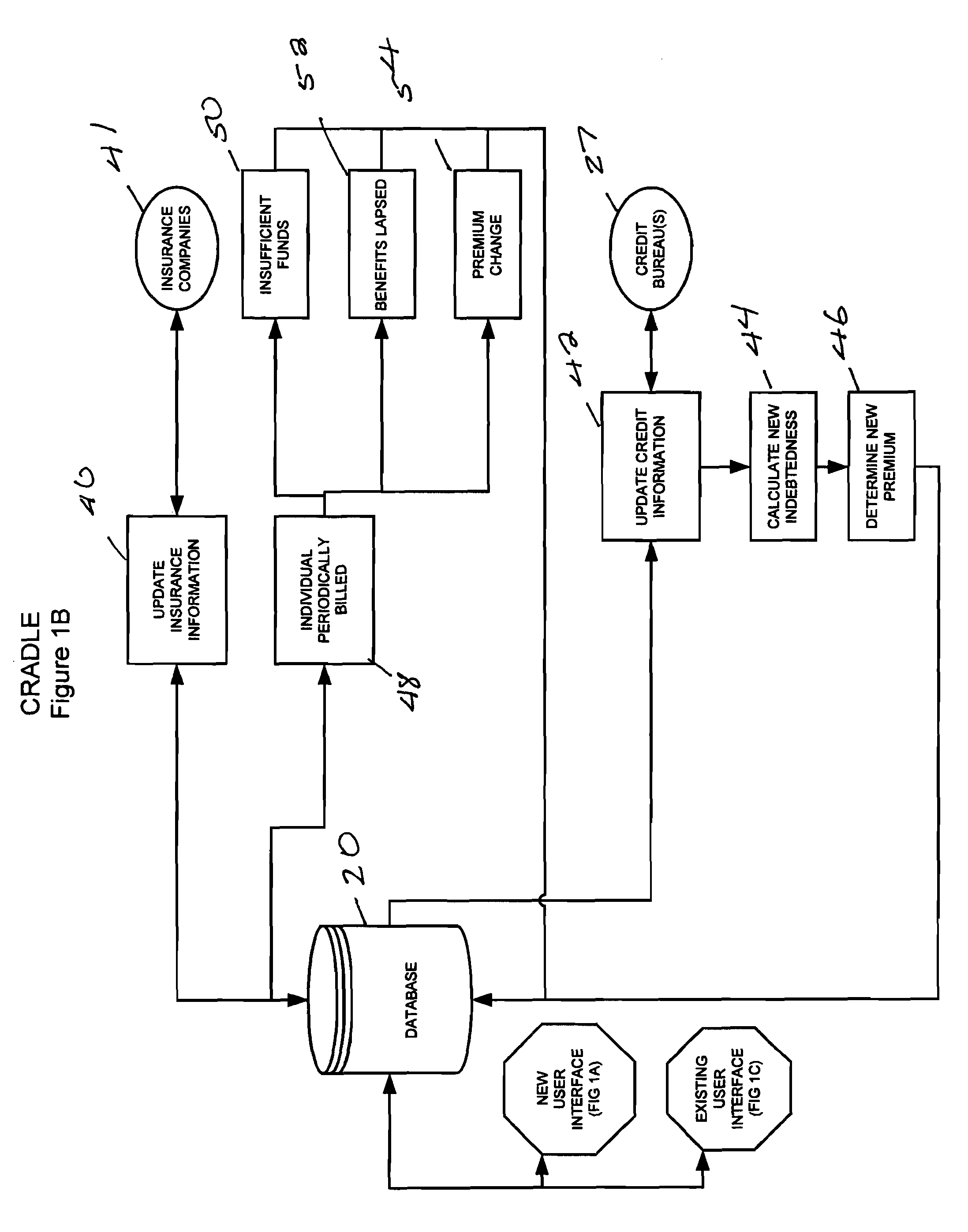

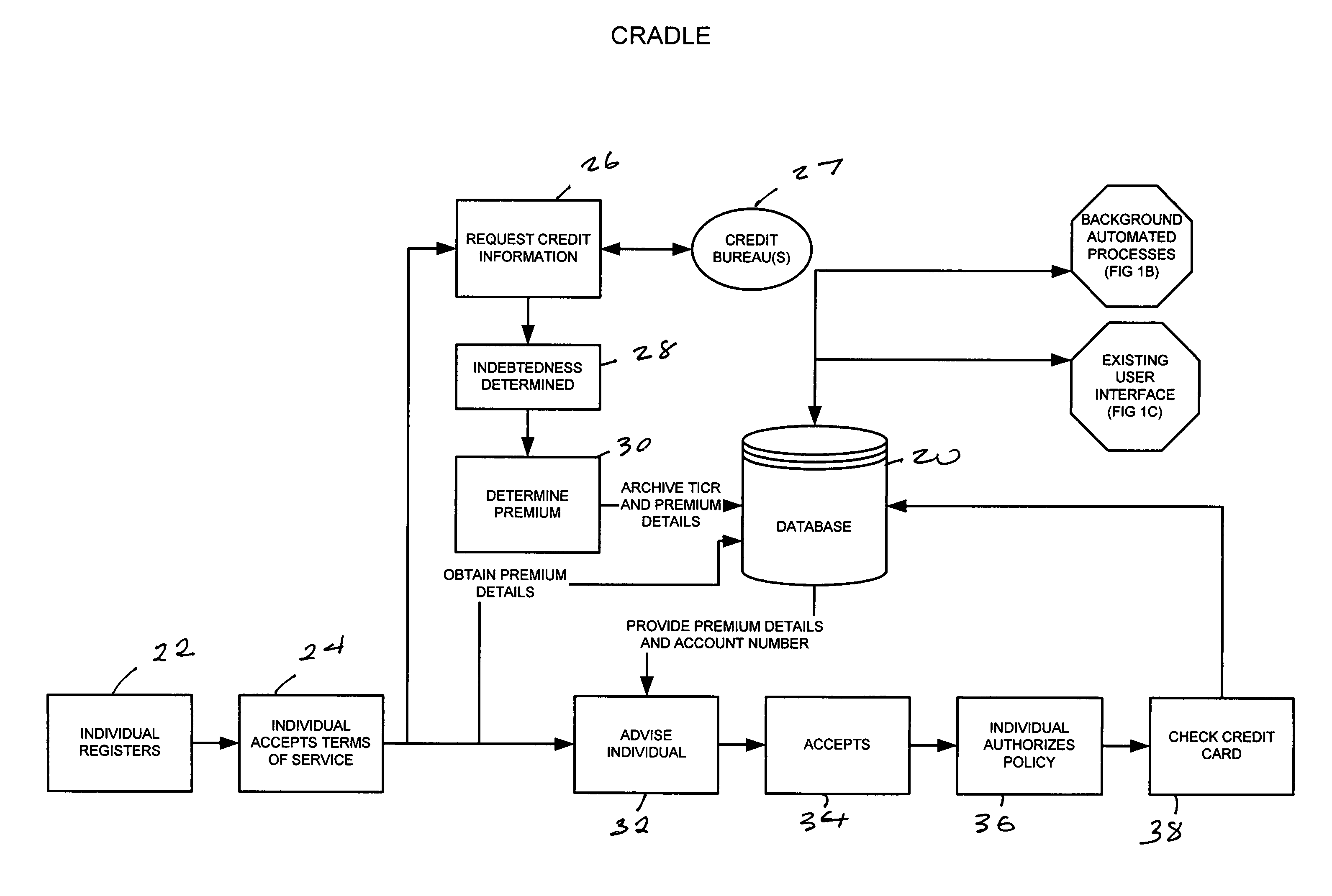

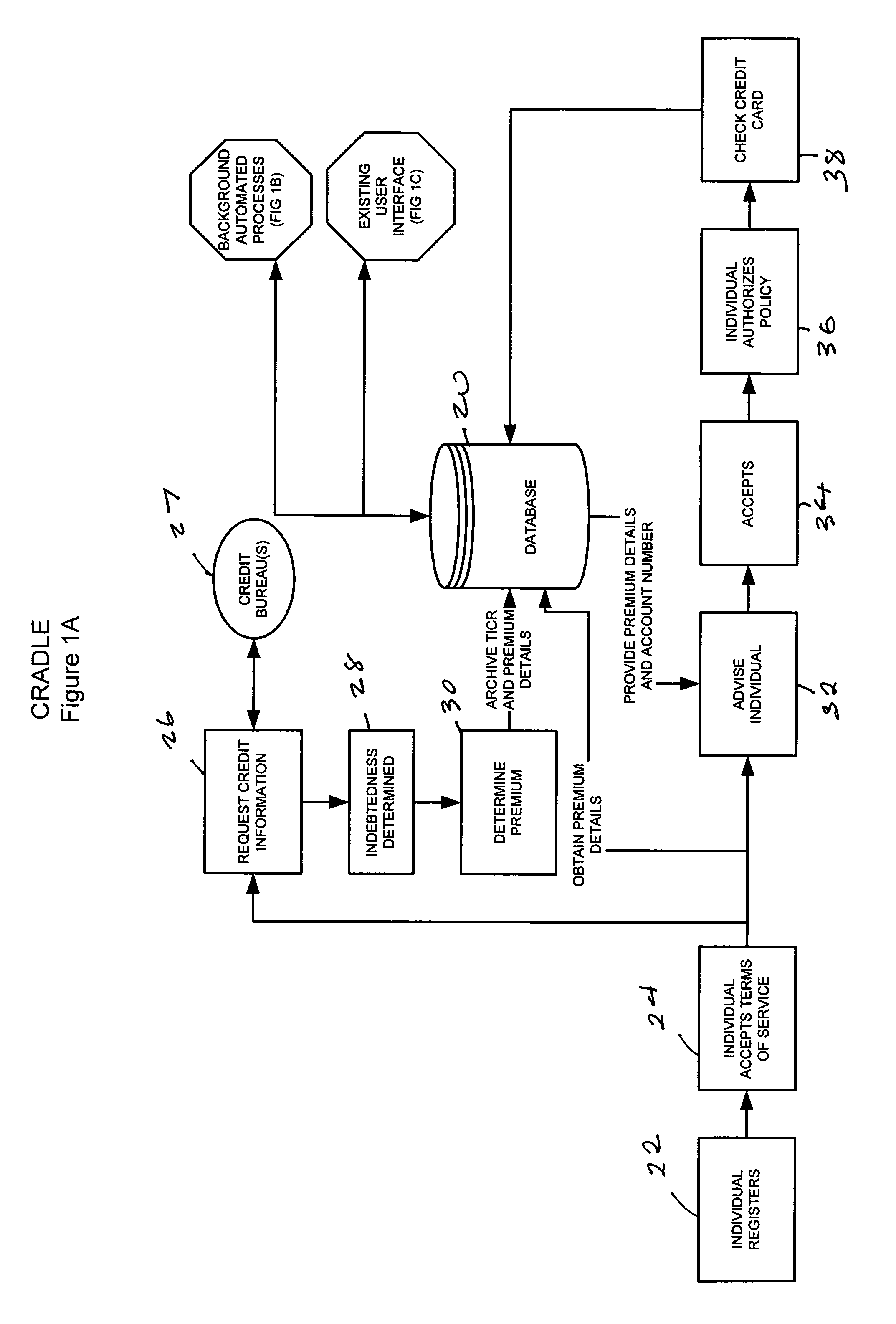

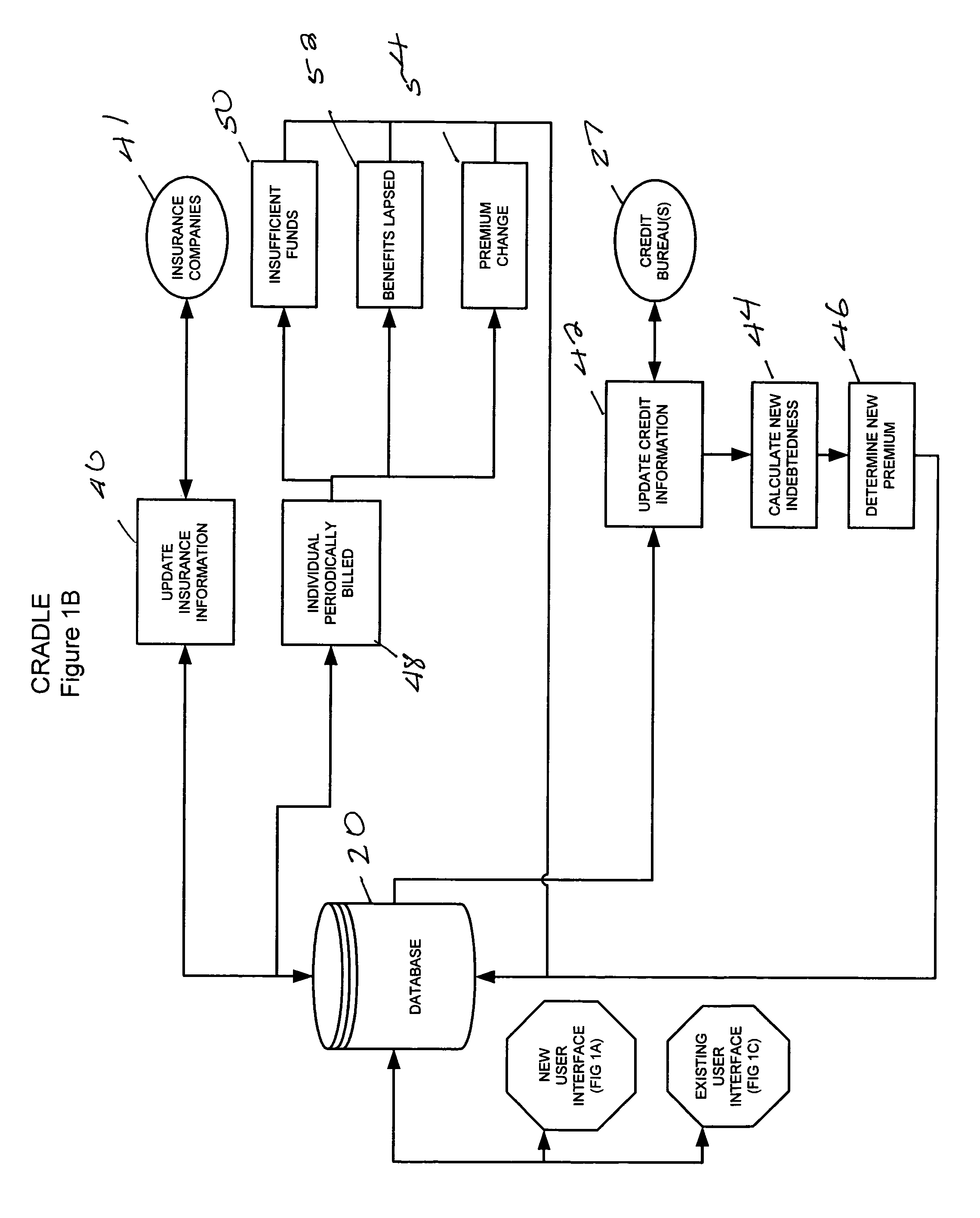

Method for determining insurance benefits and premiums from dynamic credit information

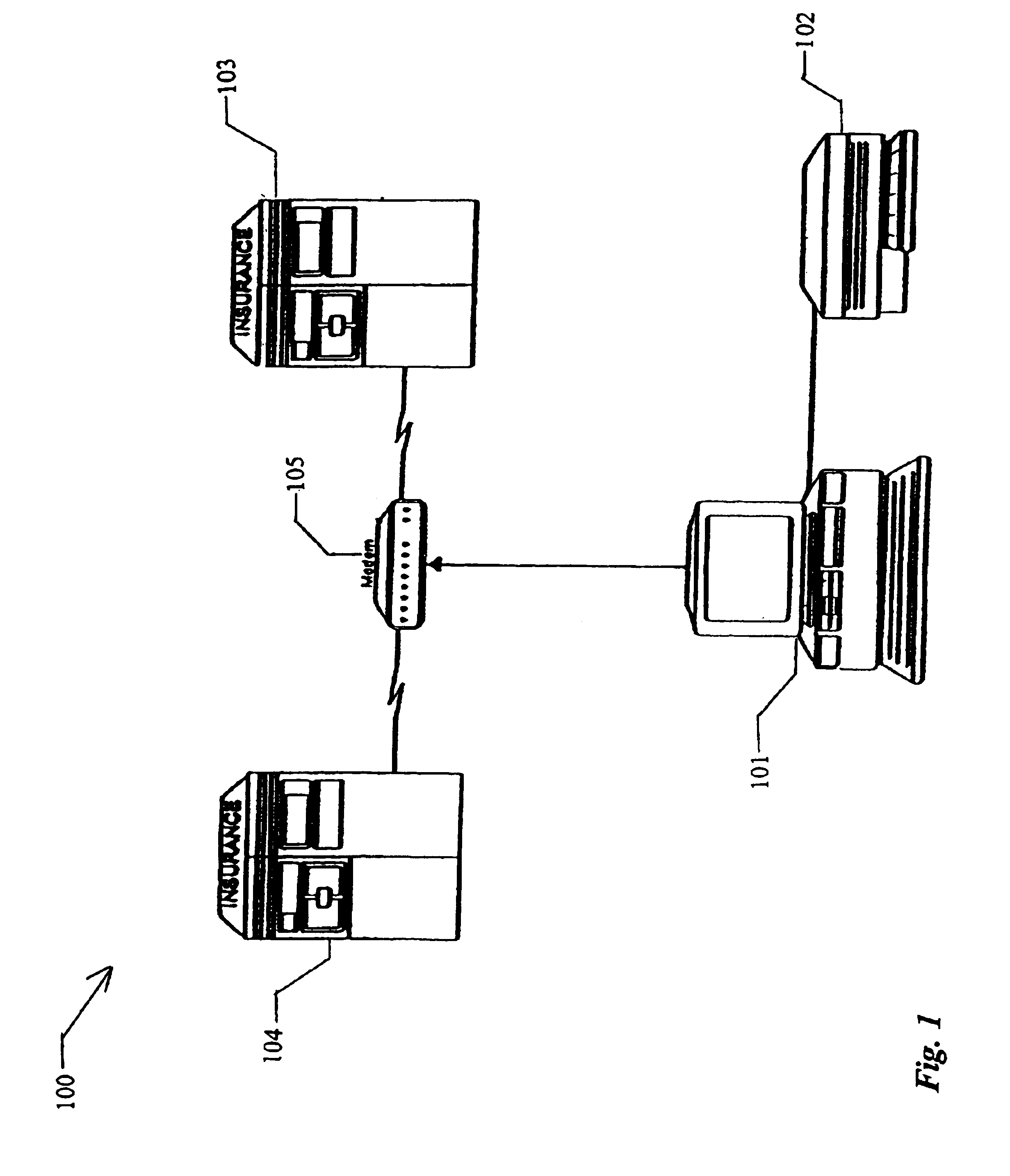

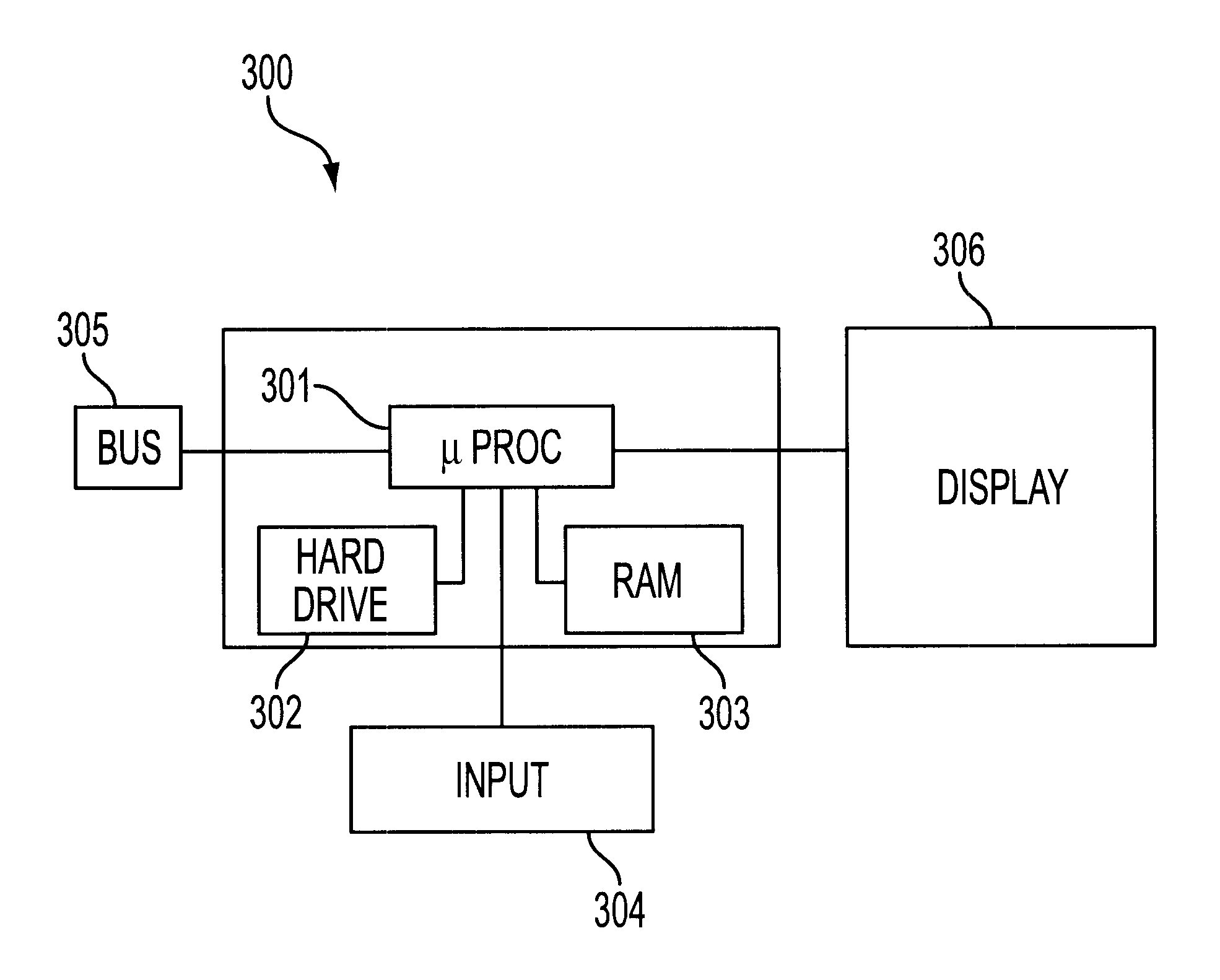

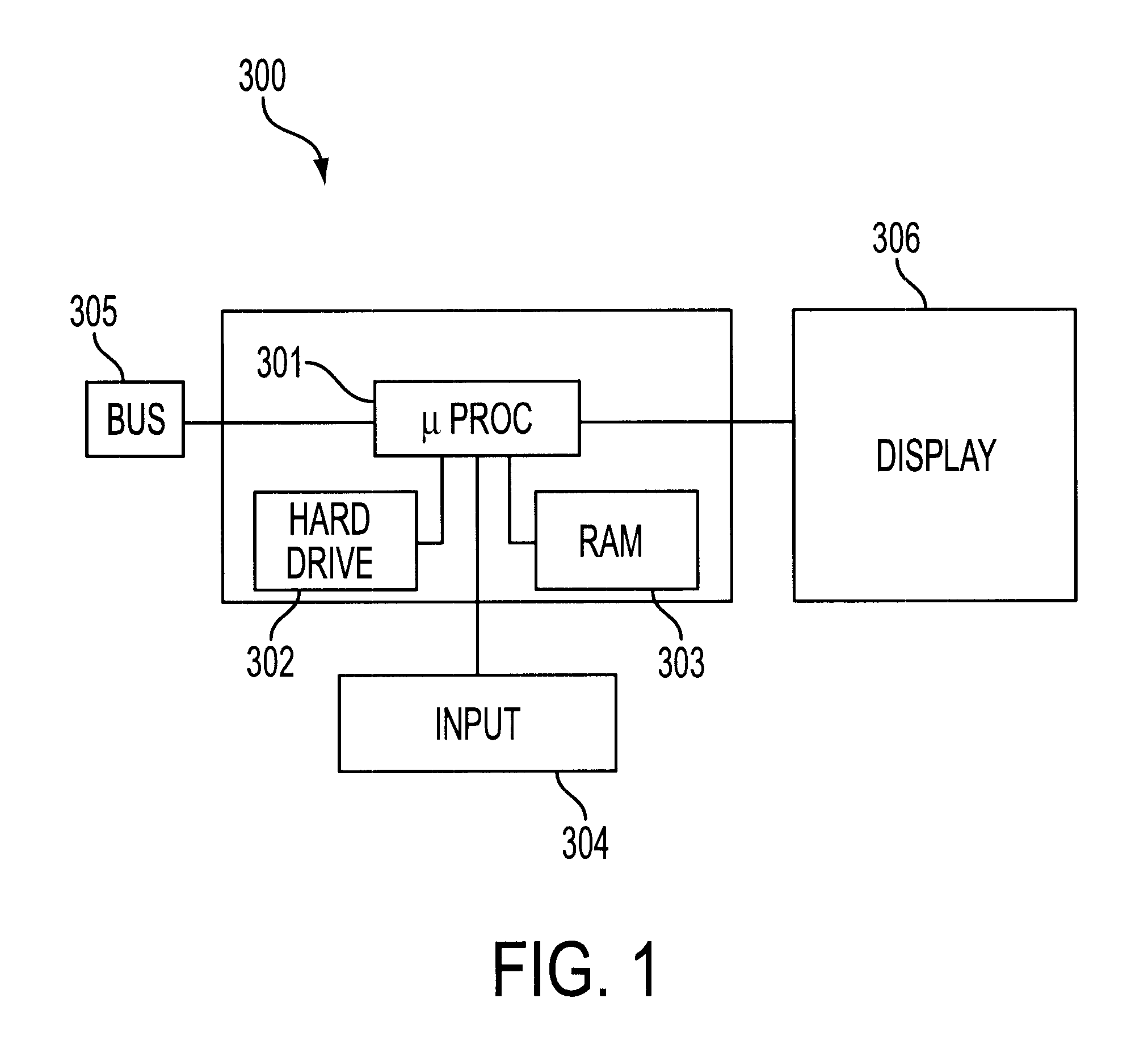

Methods for obtaining credit life insurance for an individual via a service organization are provided. In one embodiment, the method includes the steps of: 1) registering the individual with the service organization via a computer system in a computer network; 2) accessing credit information on the individual via the computer system in the computer network and determining the total debt of the individual; 3) determining the amount of debt to be covered by credit life insurance benefits; 4) creating a data base including insurance companies that provide credit life insurance benefits, the data base further including the premiums that the insurance companies charge for issuing their credit life insurance; 5) selecting specific coverage with required specific premiums; 6) obtaining the individual's approval of the required specific premiums via the computer system in the computer network; and 7) obtaining credit life insurance benefits for the individual.

Owner:CONSUMERINFO COM

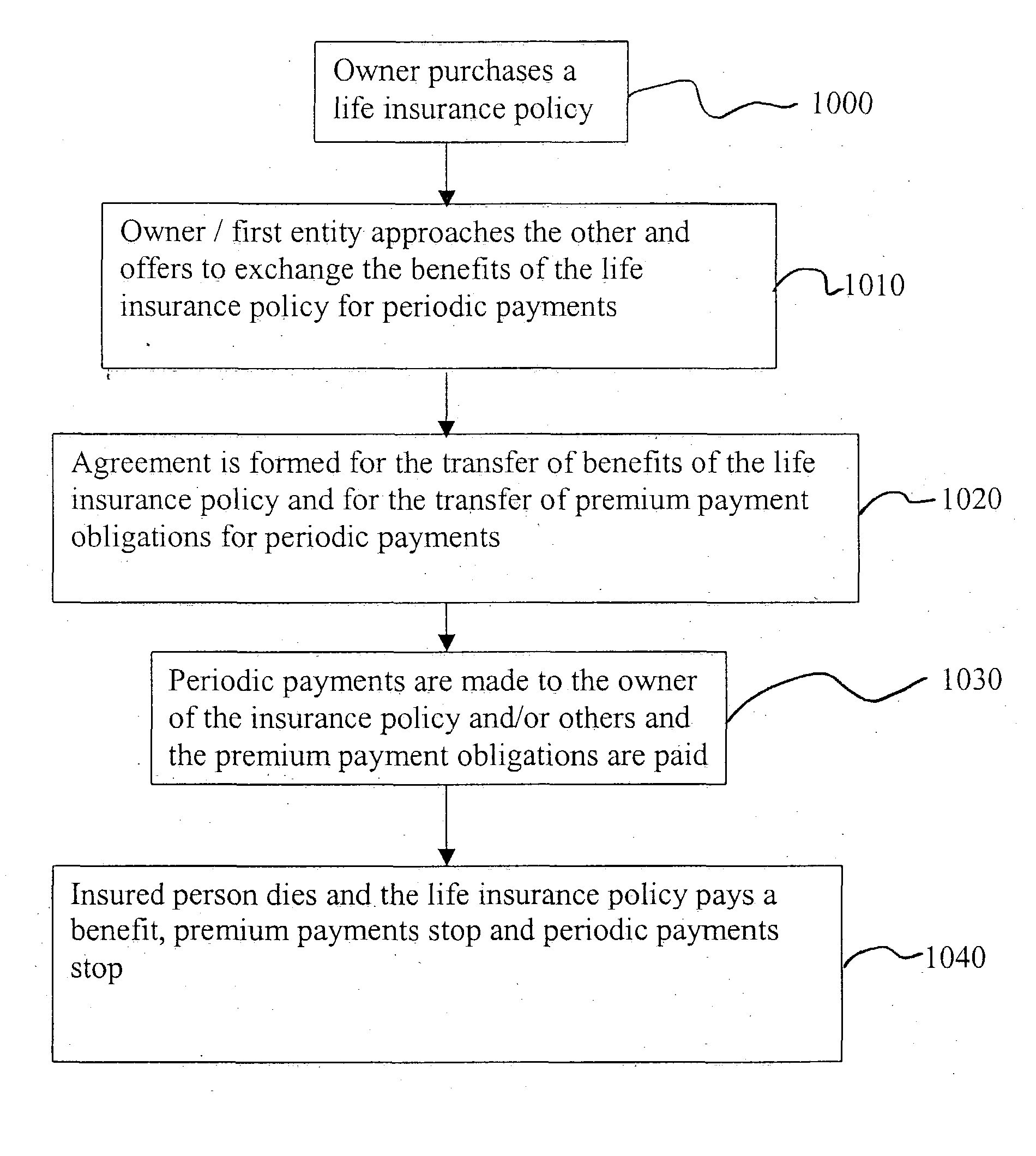

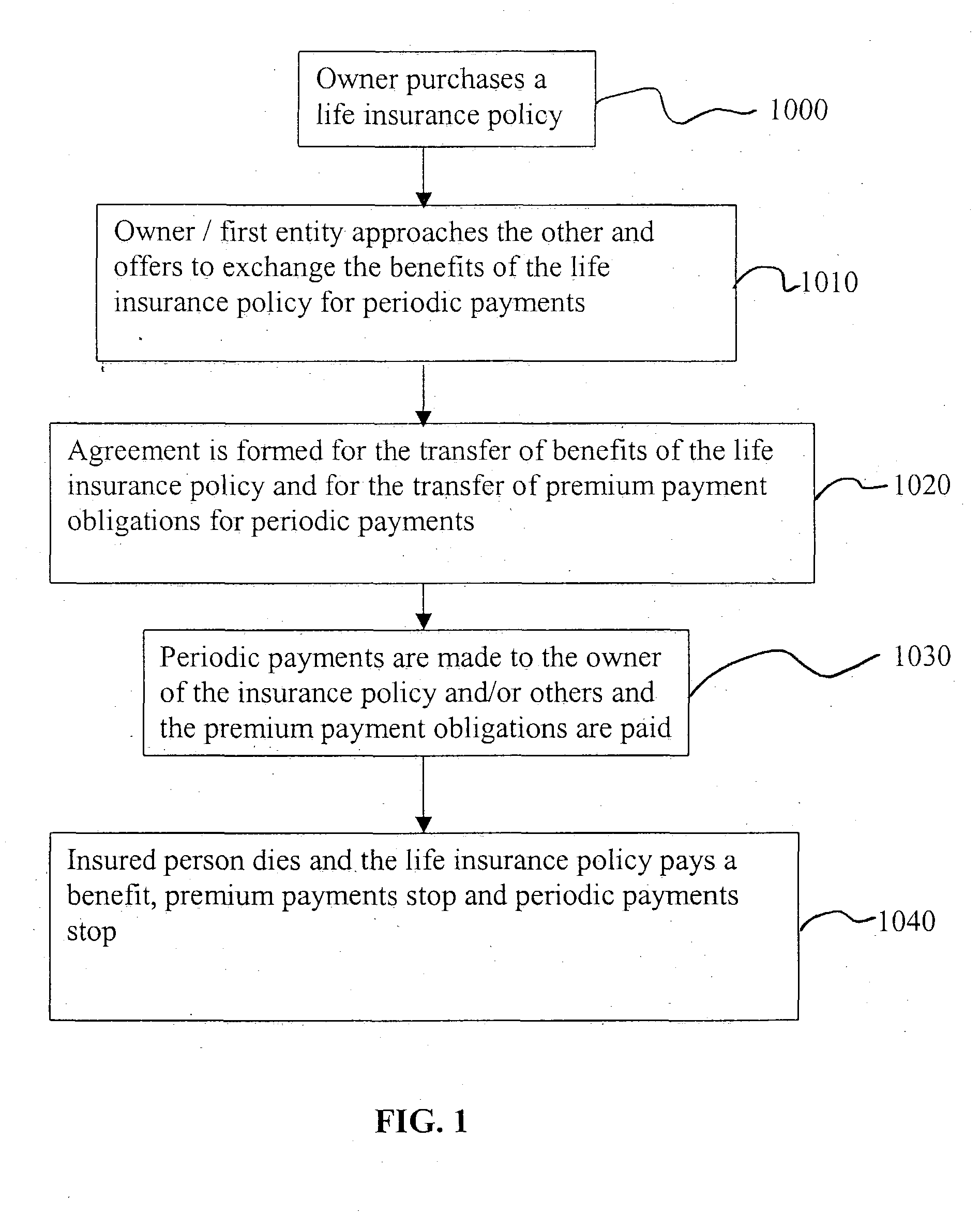

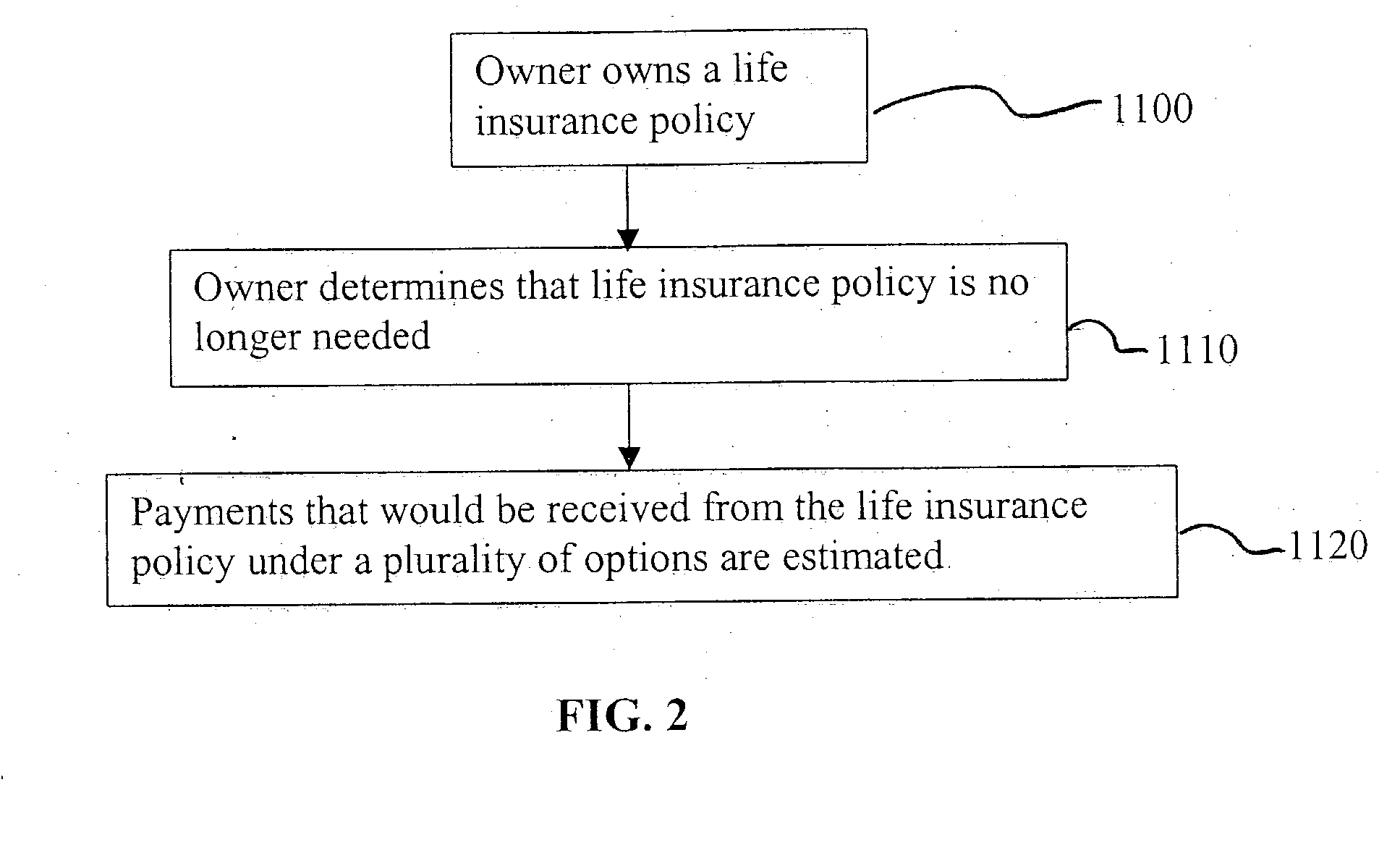

Method and system for inverse life annuity

A computer based method for investing that includes causing the formation of an agreement for the transfer of benefits of an insured's life insurance policy to a first entity and the transfer of premium payment obligations of the insured's life insurance policy to the first entity or a second entity in exchange for periodic payments for a period of time to at least one of an owner of the life insurance policy and a third entity, wherein the period of time is based on at least one of a fixed period and the life of the insured.

Owner:TERLIZZI JAMES D +1

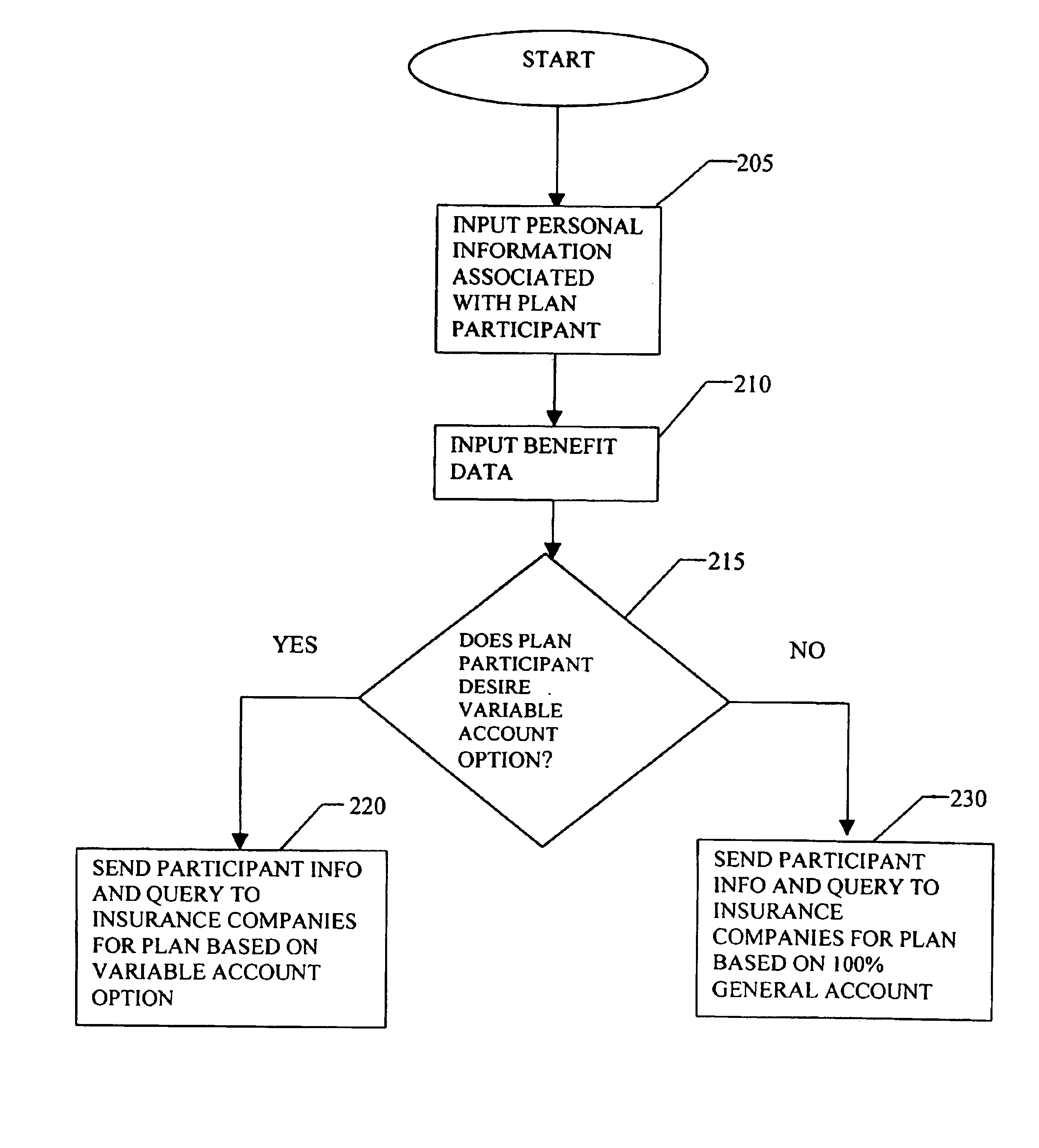

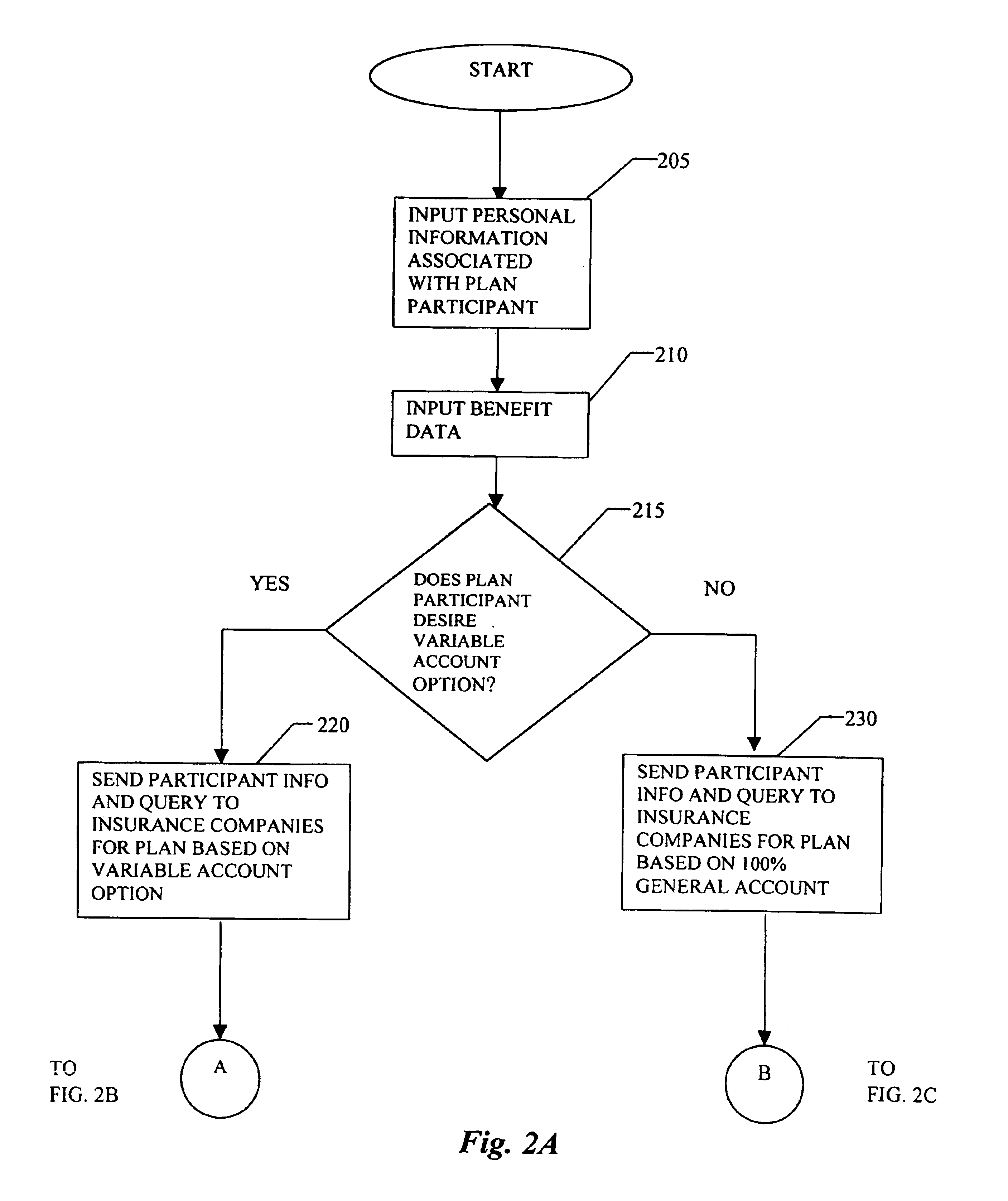

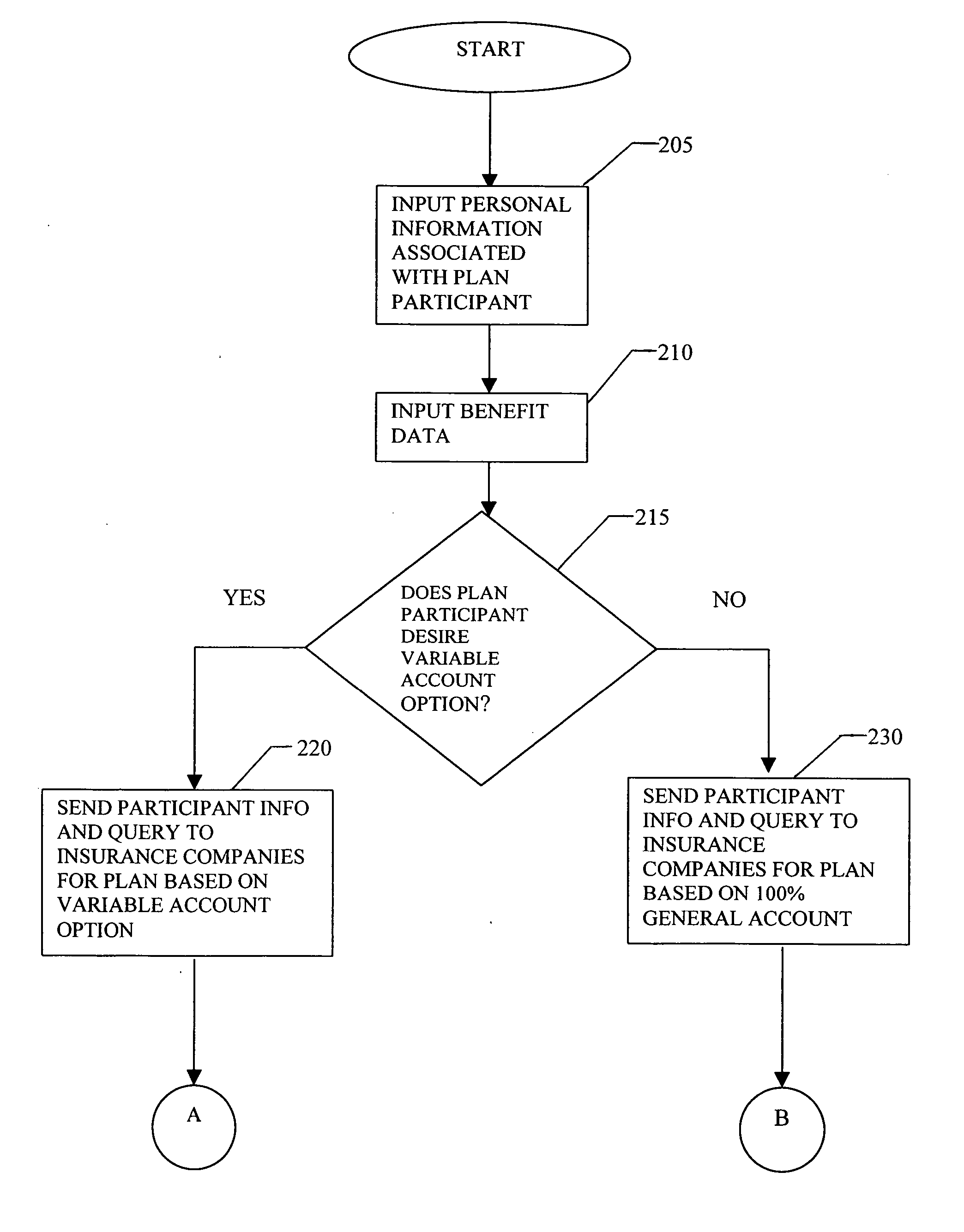

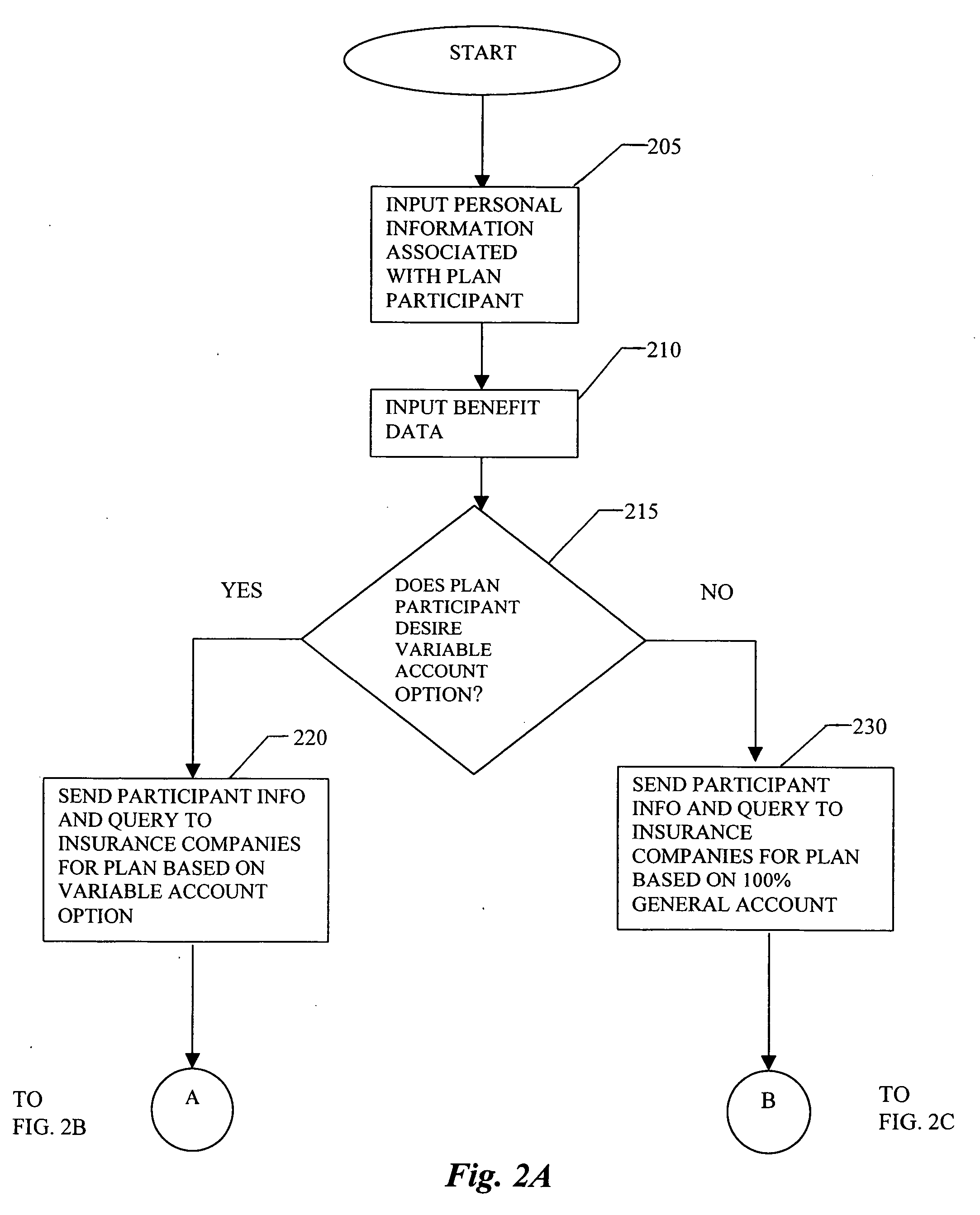

System and method for creating a defined benefit pension plan funded with a variable life insurance policy and/or a variable annuity policy

A defined benefit pension plan, such as a plan described in Internal Revenue Code Section 412(i), is created using variable life insurance contracts and / or variable annuity contracts. Actuarial data used to create the defined benefit pension plan is entered via at least one user interface and processed. Based on the actuarial data, a variable life insurance policy and / or a variable annuity policy is generated for the purpose of funding the defined benefit pension plan. Additionally, a separate agreement is created that either extra-contractually modifies the variable life insurance policy and / or the variable annuity policy, or defines the terms under which the variable life insurance policy and / or the variable annuity policy is to be used in the defined benefit pension plan. Thus, a mechanism is provided to avoid violation of the Internal Revenue Service “incidental benefit rule” and to provide a guaranteed rate of return such that the variable life insurance contracts and / or the variable annuity contracts can be used in a plan described in a retirement plan, including a plan described in Code section 412(i).

Owner:KORESKO V JOHN J

Method and apparatus for modeling and executing deferred award instrument plan

InactiveUS6609111B1Minimal impactMinimizes taxFinanceOffice automationProgram planningInsurance life

The present invention is directed to the administration of various deferred compensation programs that can effectively reduce an individual's income or estate tax by assisting a company in the identification of appropriate employees, and through the use of a novel modeling method and apparatus to implement a deferred compensation program through a novel Rabbi Trust maintenance plan that permits the employees to benefit from their deferred compensation (such as stock options or life insurance benefits), while having a minimal financial impact on the company.

Owner:BELL LAWRENCE L

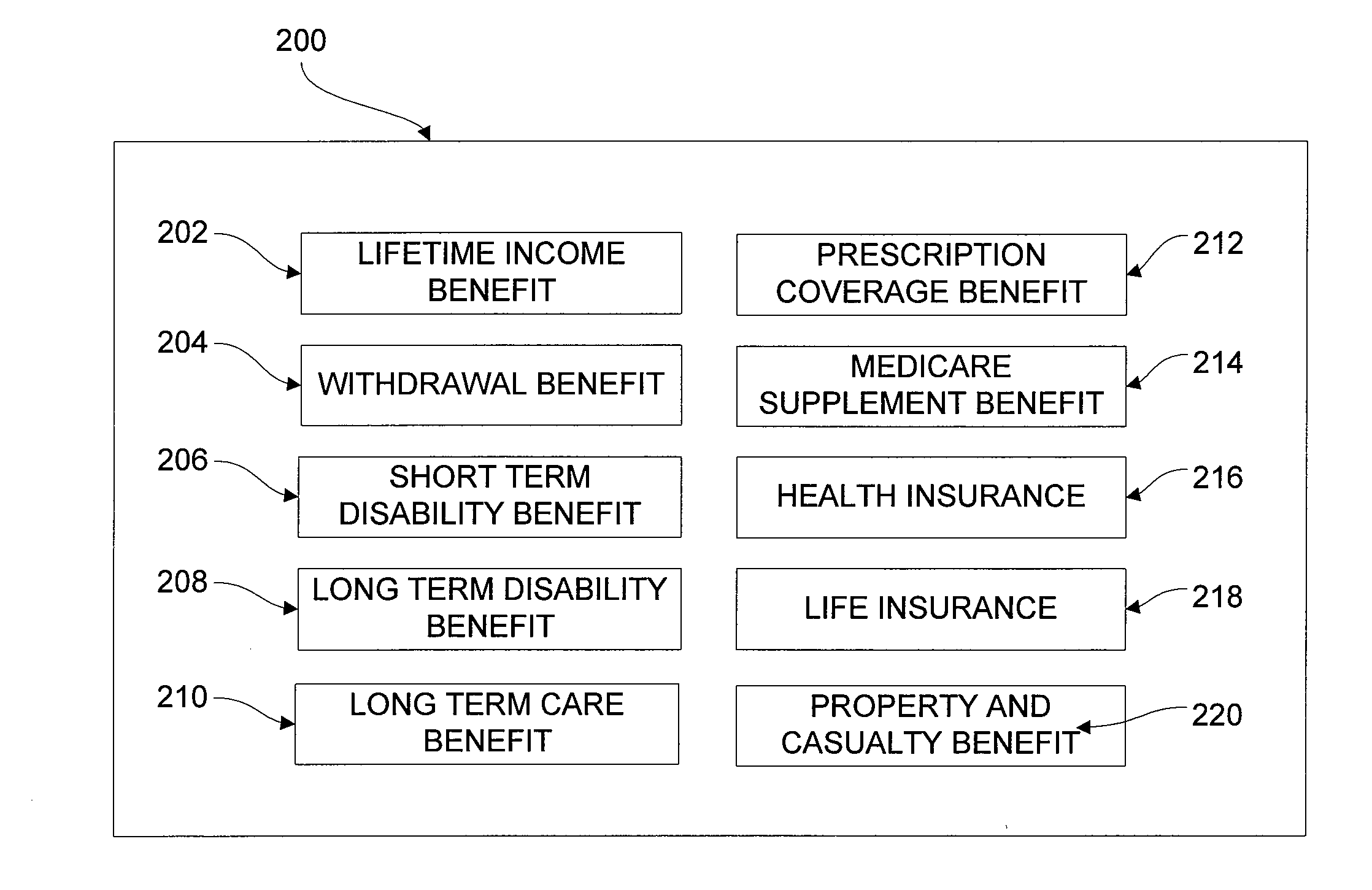

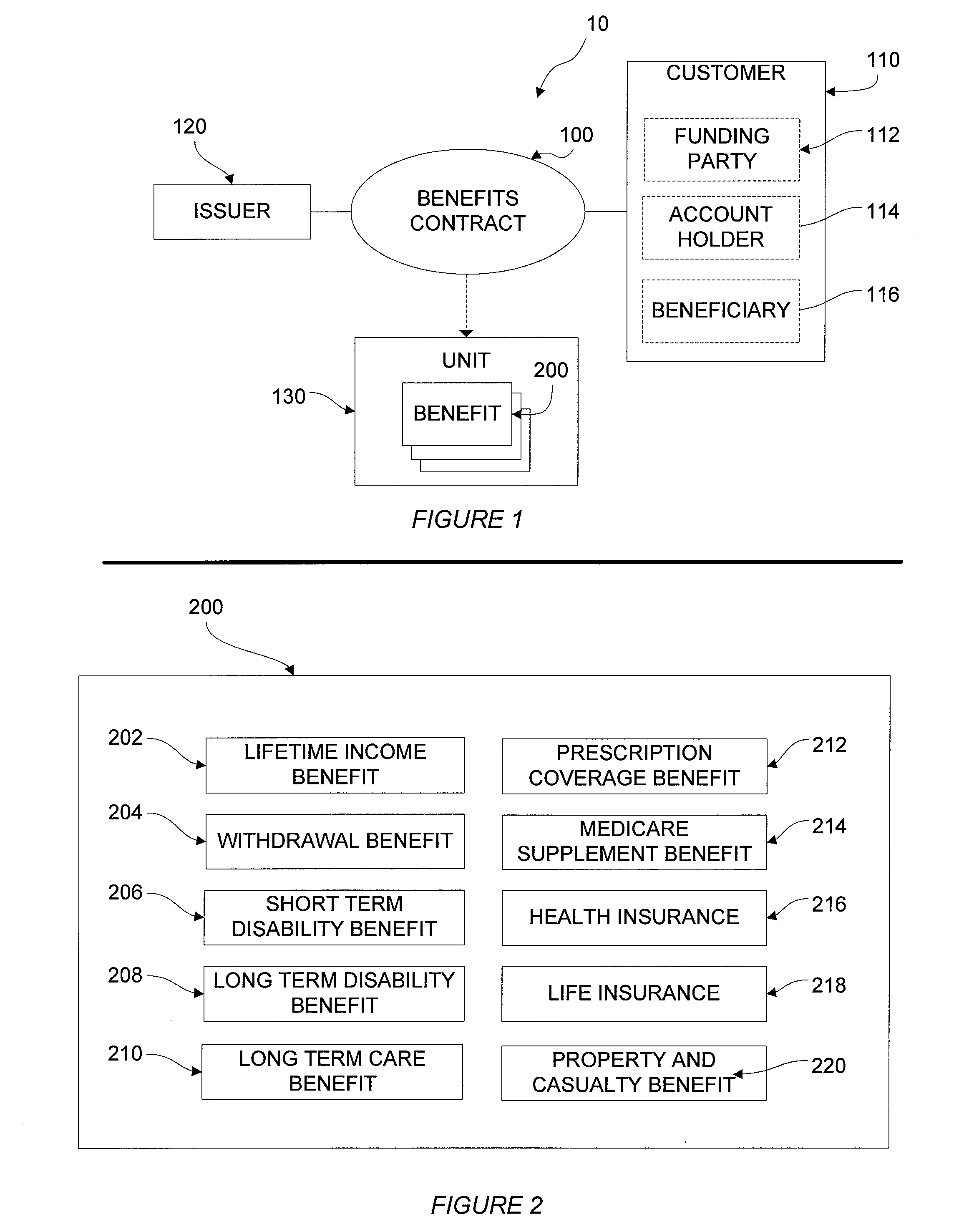

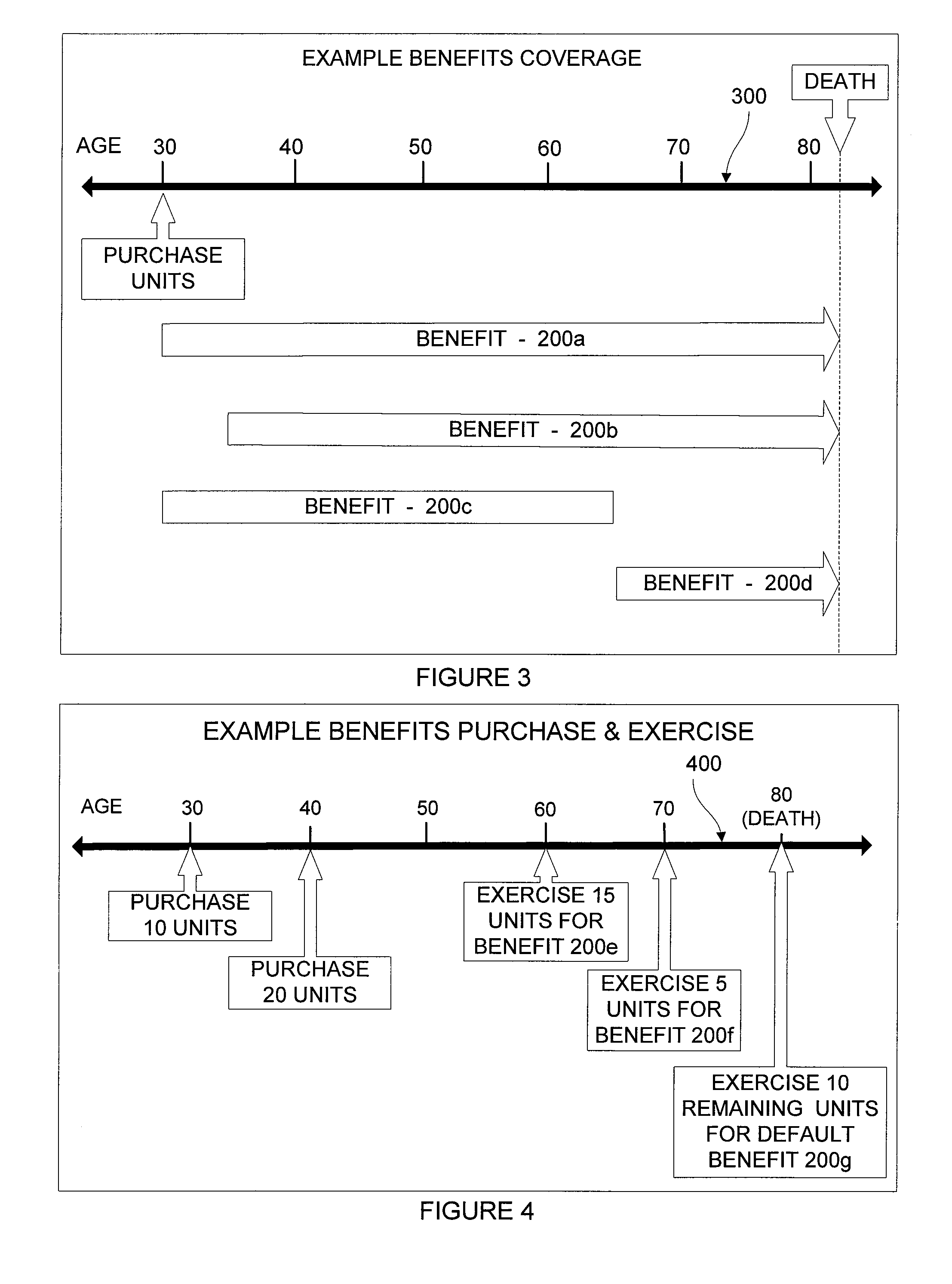

Benefits Contract Providing a Bundle of Benefits

ActiveUS20070021986A1Simplify decision making processLow costFinanceCommerceInsurance lifeLong-term care insurance

According to one embodiment of the invention, a benefits contract includes an agreement to provide a plurality of benefits for at least one person. The agreement provides for an account including a plurality of units. Each unit is associated with multiple benefits. For example each unit may be associated with multiple benefits such as life insurance, health insurance, supplemental health insurance, long-term care insurance, short-term disability insurance, long-term disability insurance, prescription drug insurance, a plurality of income payments, a withdrawal benefit, an annuity, a property and casualty benefit, or other similar benefits. The agreement is such that a person associated with the benefits contract may choose to exercise a particular unit, or fraction thereof, to receive only one of the three or more benefits; and such that the benefits account (or plurality of units) may be purchased tax-free using funds from a tax-deferred retirement account.

Owner:PRUDENTIAL INSURANCE OF AMERICA

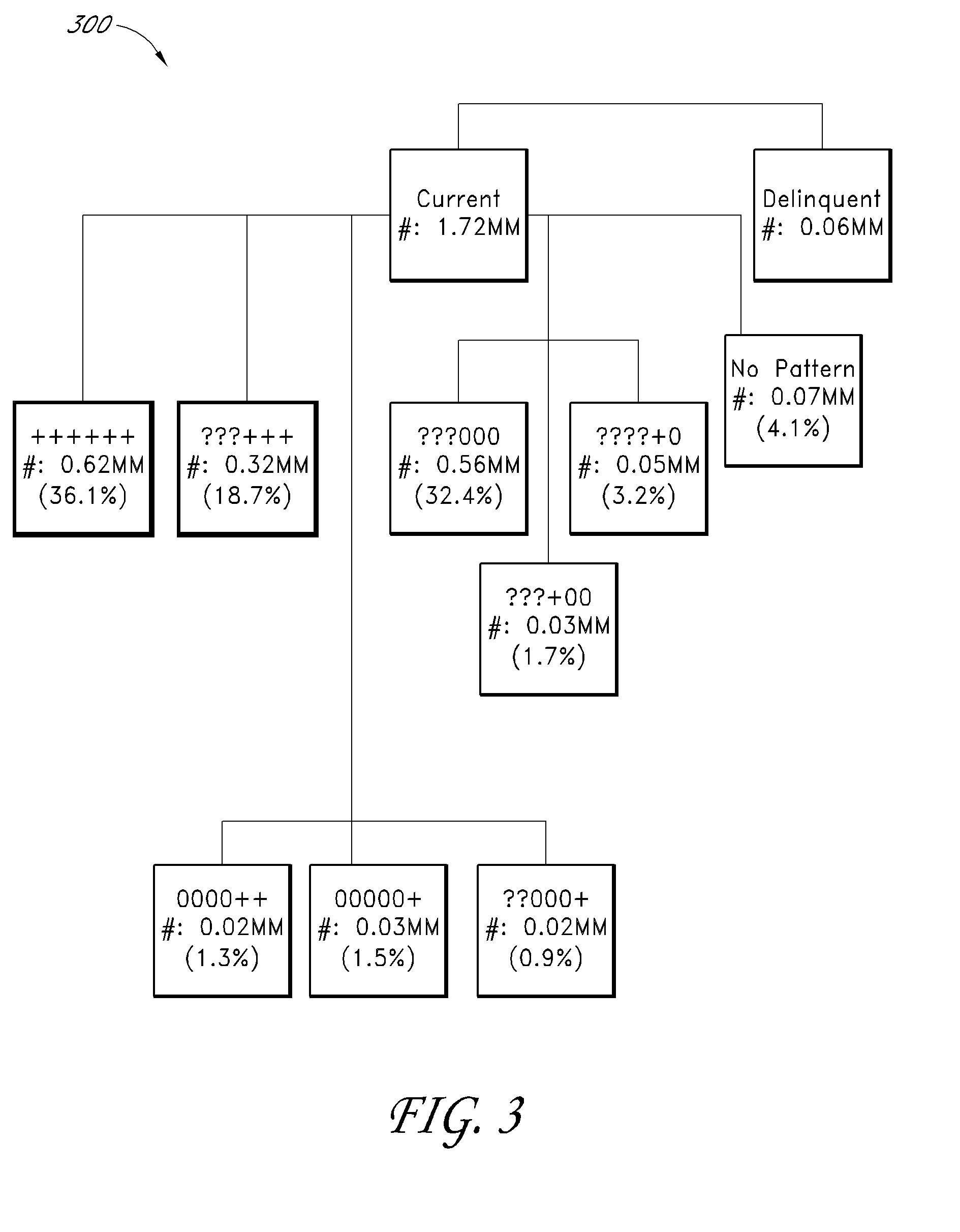

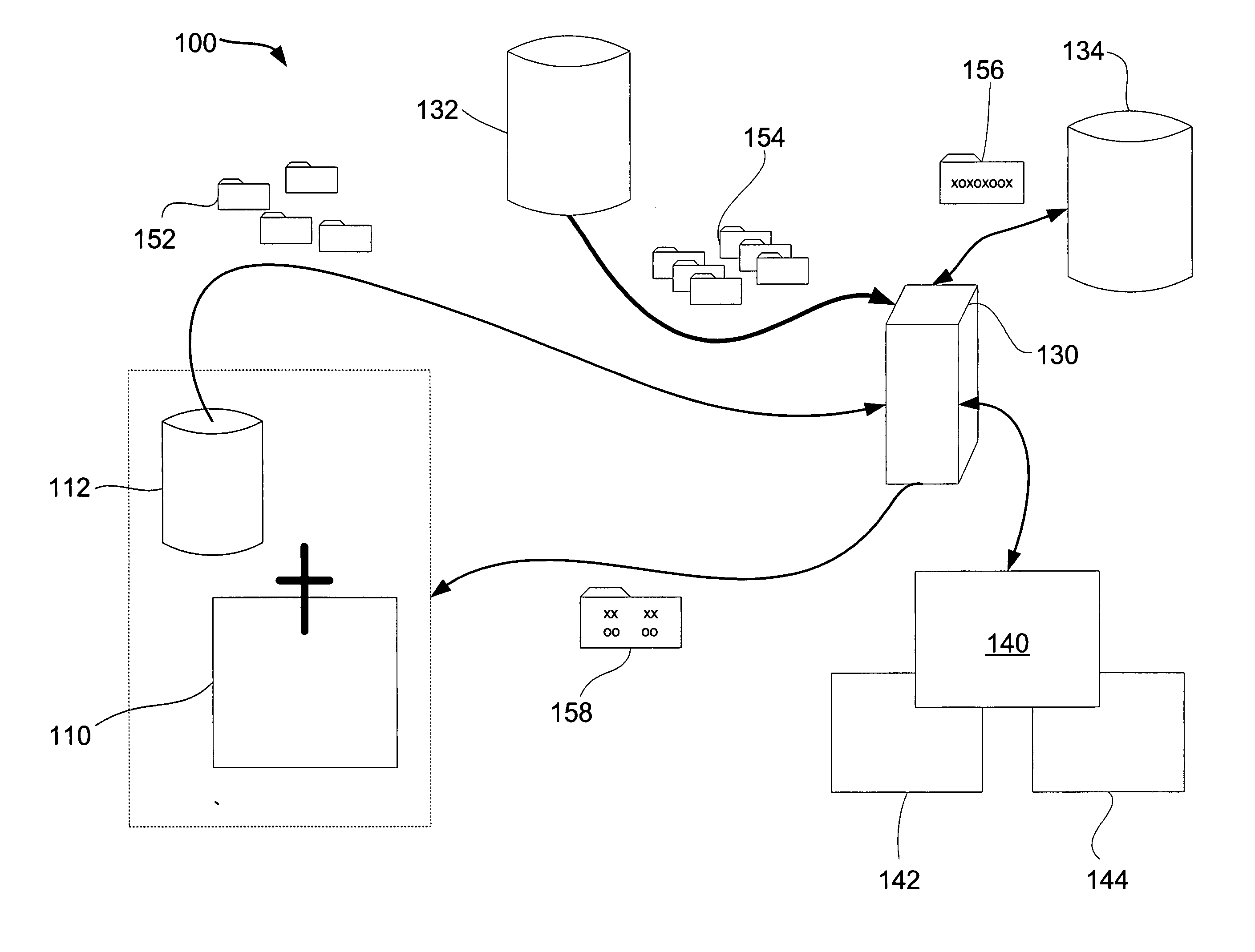

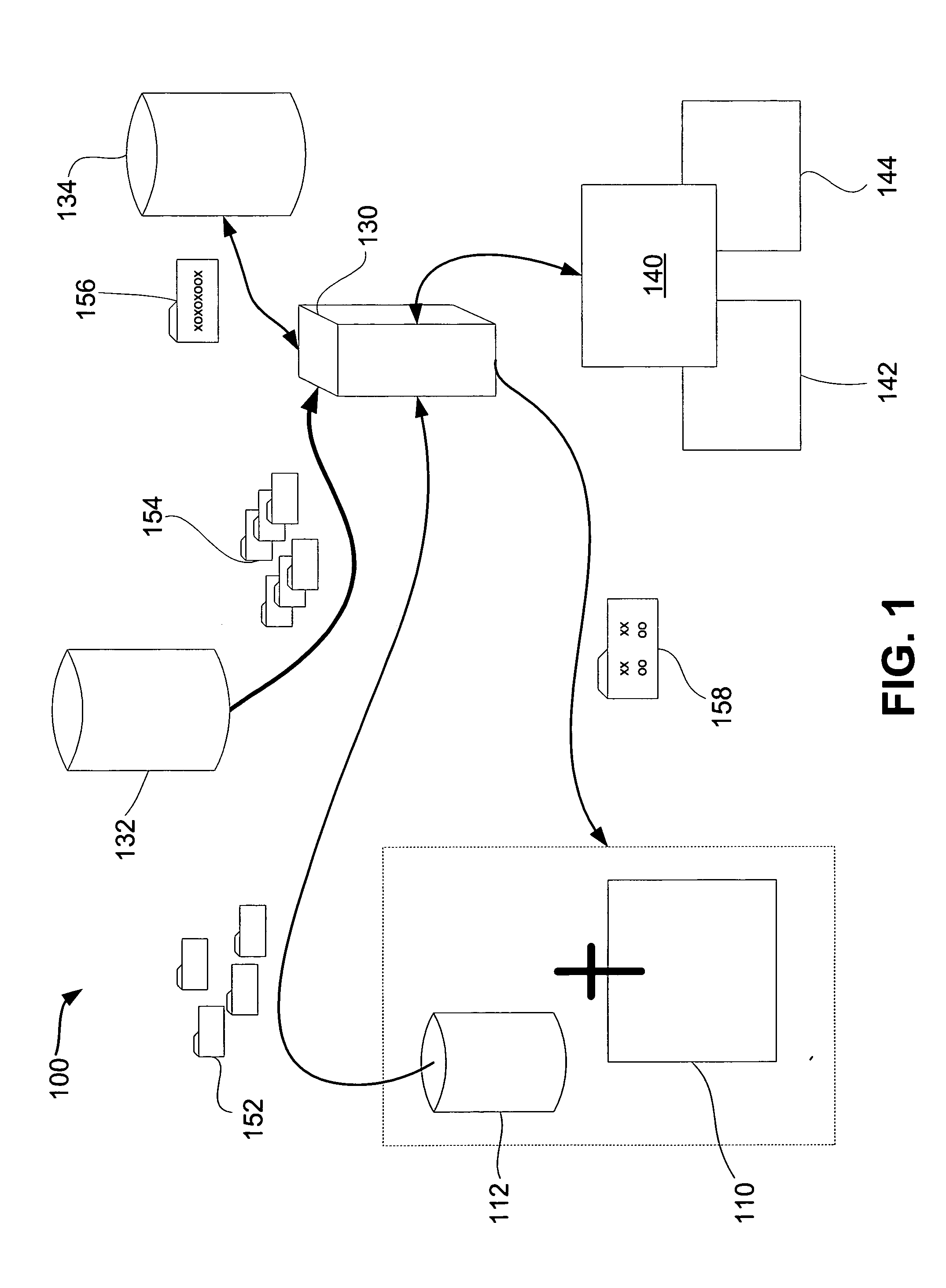

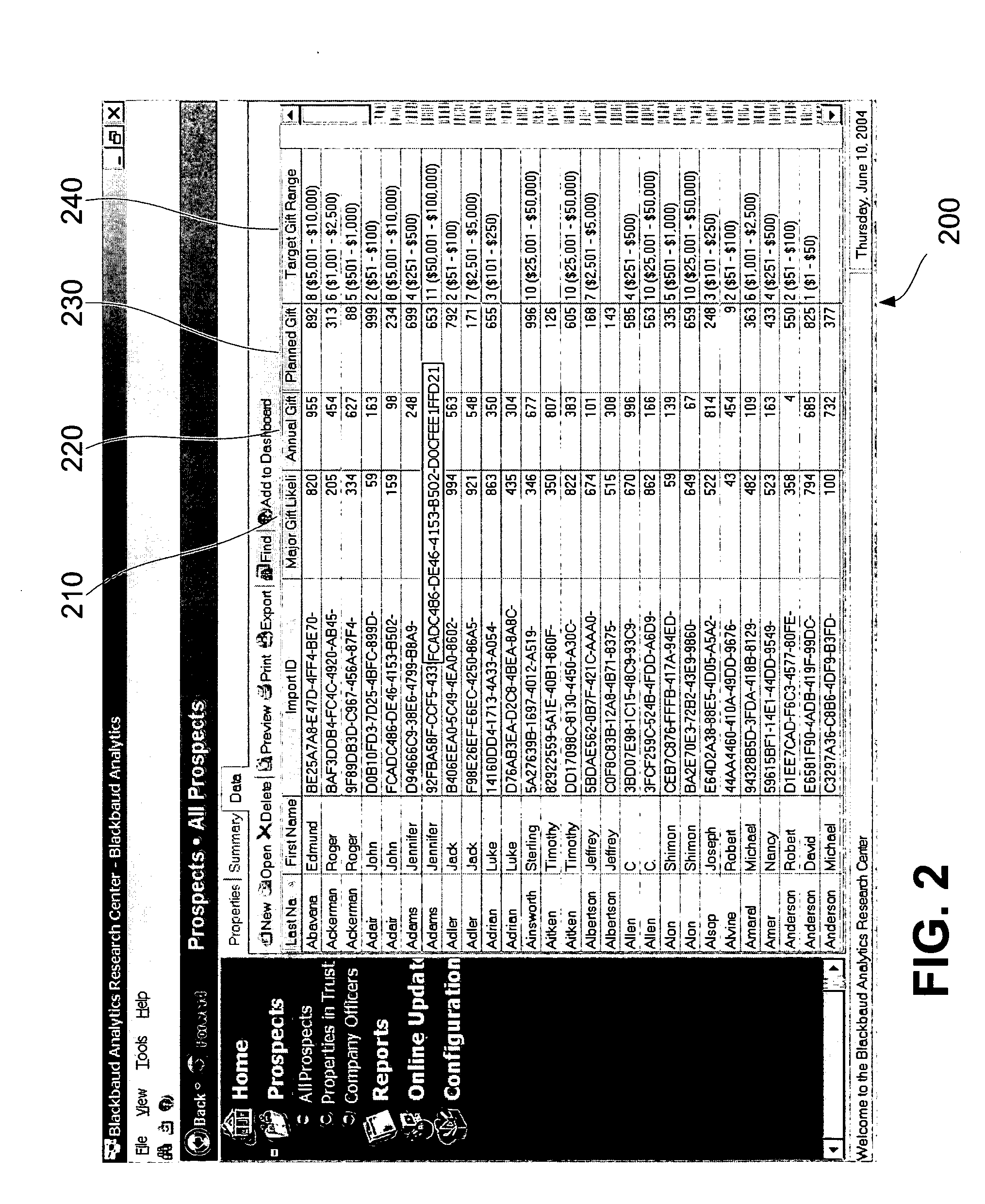

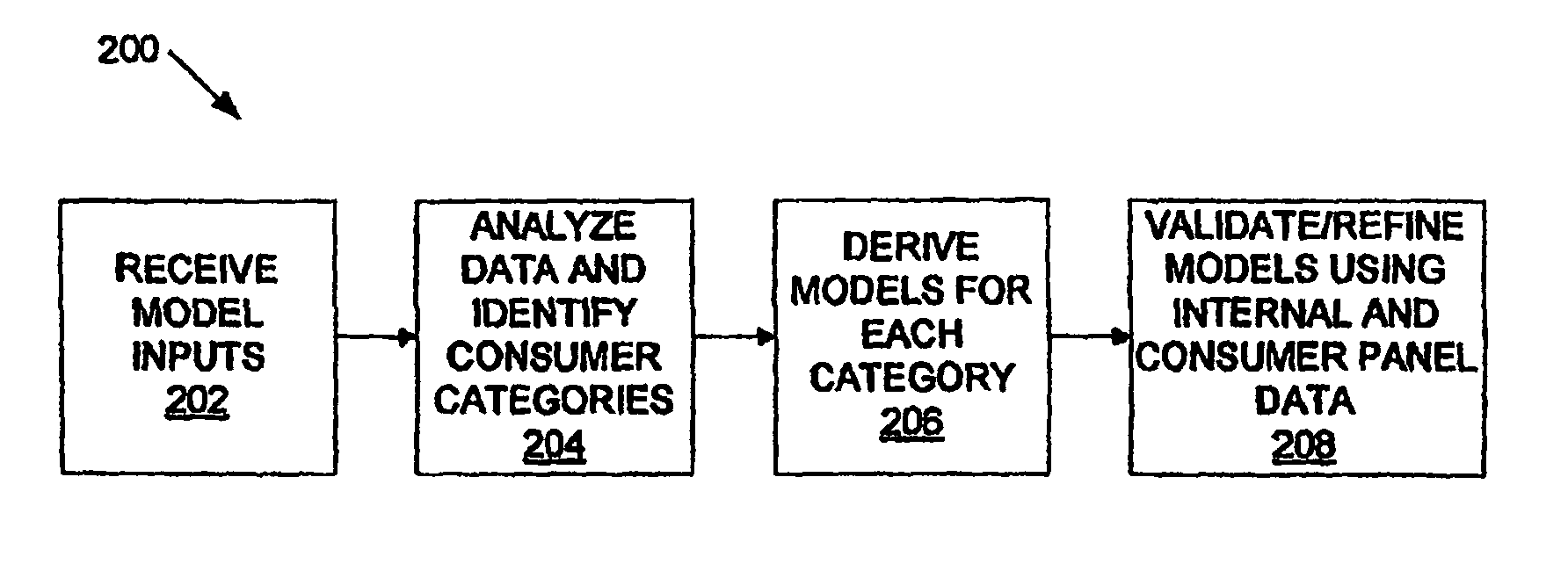

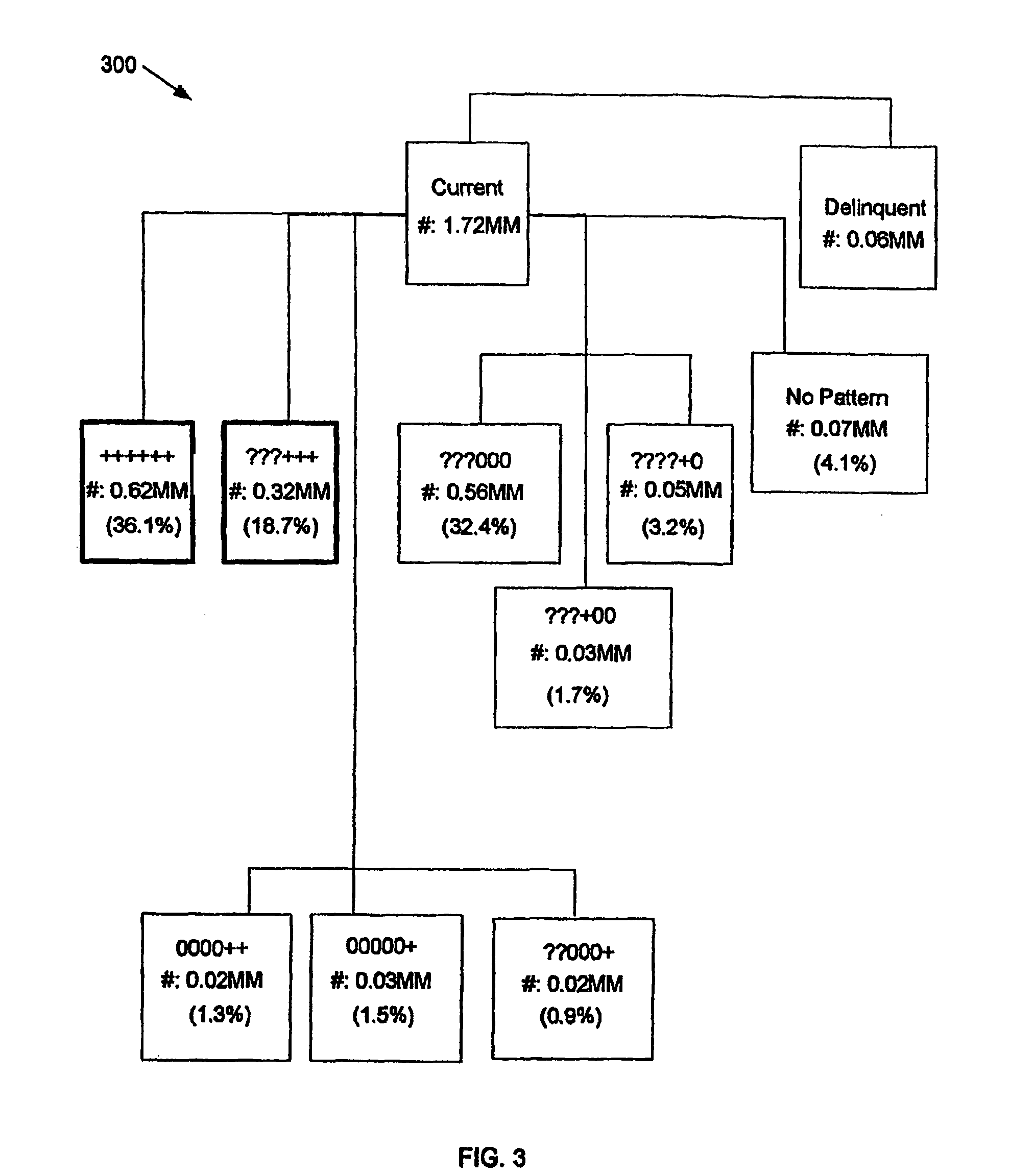

System and methods for maximizing donations and identifying planned giving targets

InactiveUS20050065809A1Accurate segmentationReducing expensive mailingFundraising managementOffice automationLimited resourcesNon profit

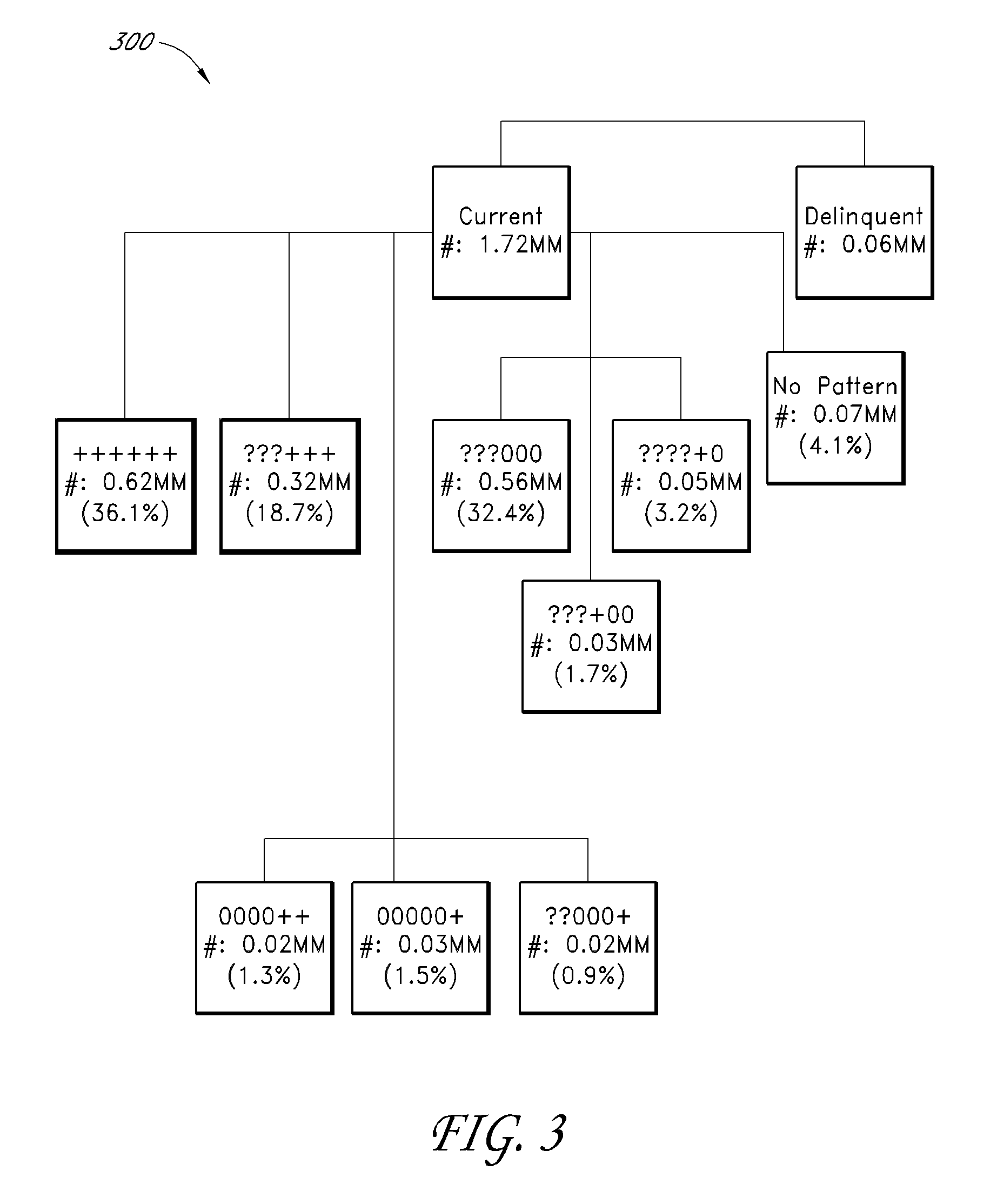

To enable a non-profit to make informed decision about how to spend its limited resources efficiently to maximize its donations, systems and methods to determine prospect propensity and prospect capacity to identify what types of donations, such as annual gifts, major one-time gifts, or planned gifts, the non-profit should solicit from its pool of prospective donors and the likely amount of each such gift. Systems and methods that enable the non-profit further to identify what types of planned gift, such as bequests, charitable remainder trusts, charitable gift annuities, pooled income funds, and life insurance, it should solicit from each of its prospective donors. The systems and methods use models developed using statistical analysis to generate relative scores for all prospective donors in the pool. Such scores and additional wealth information are provided to the non-profit in electronic format for further manipulation and use.

Owner:BLACKBAUD

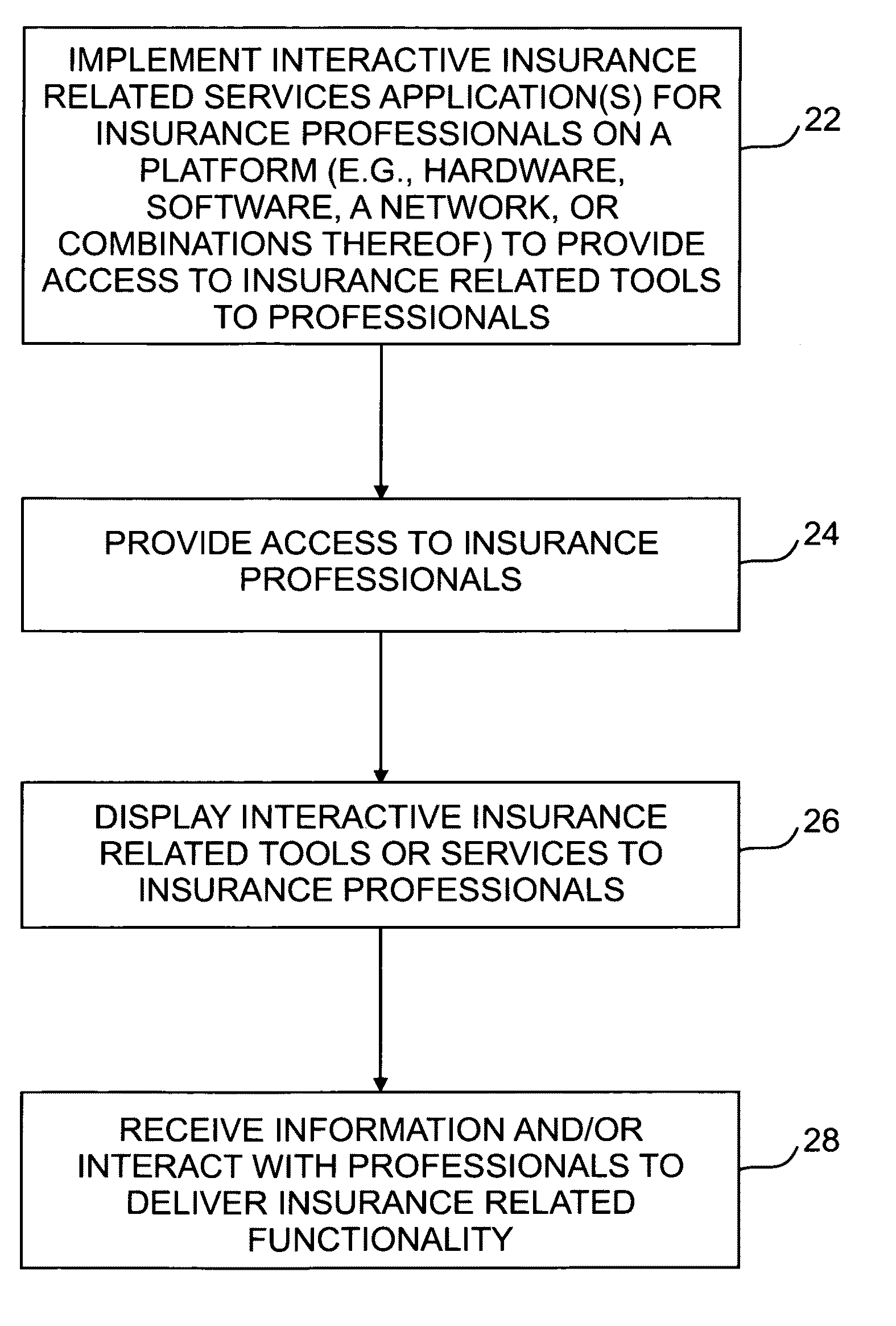

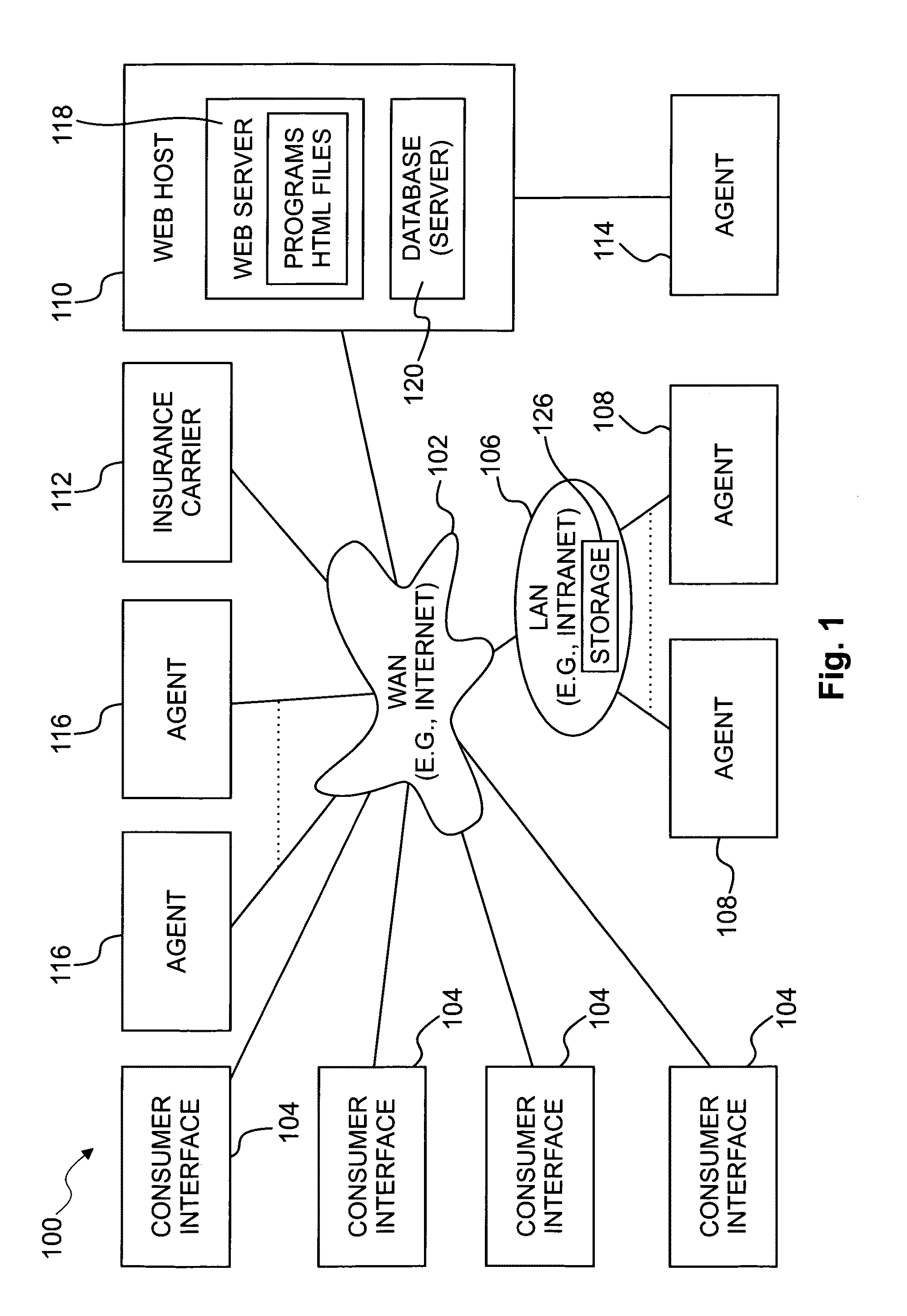

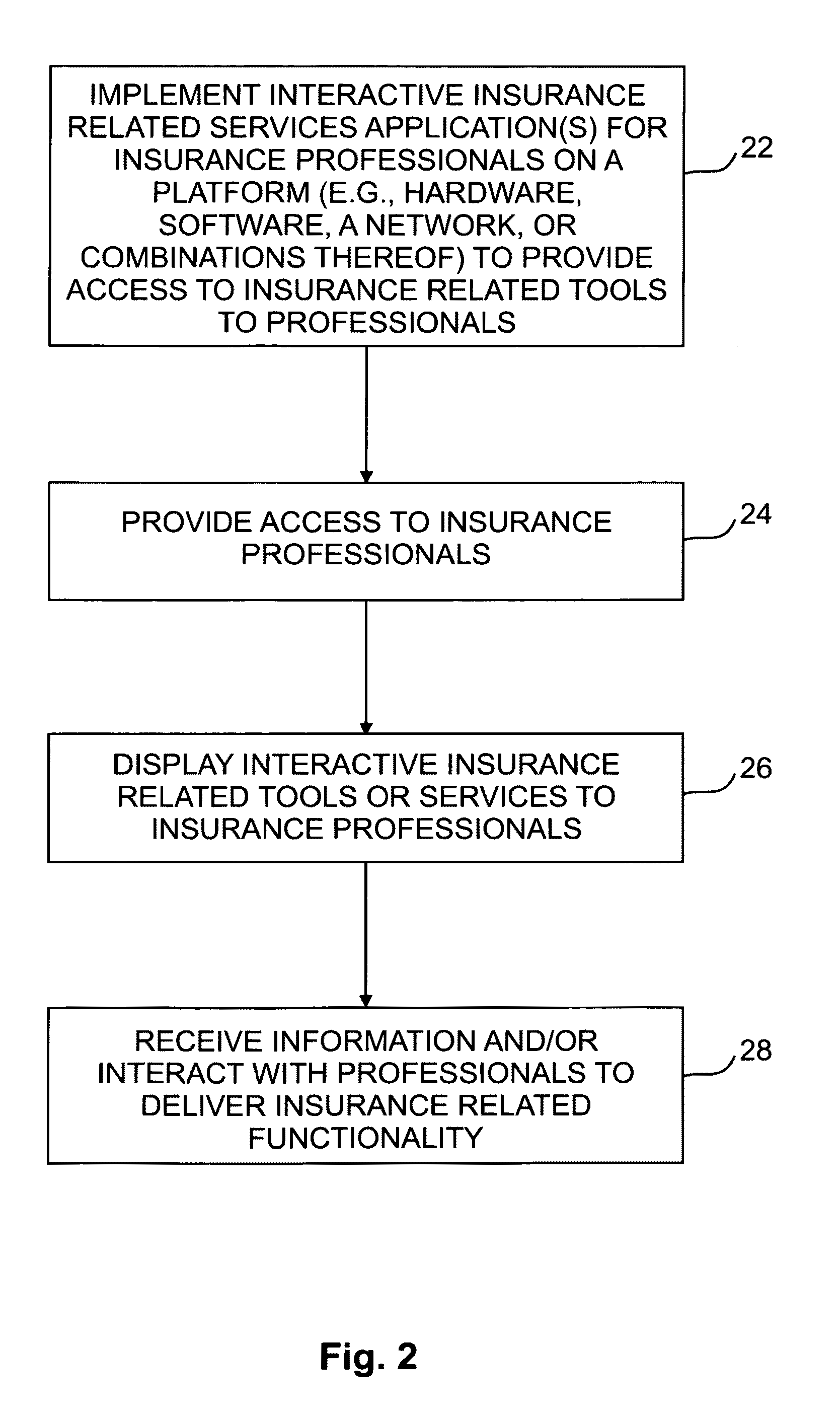

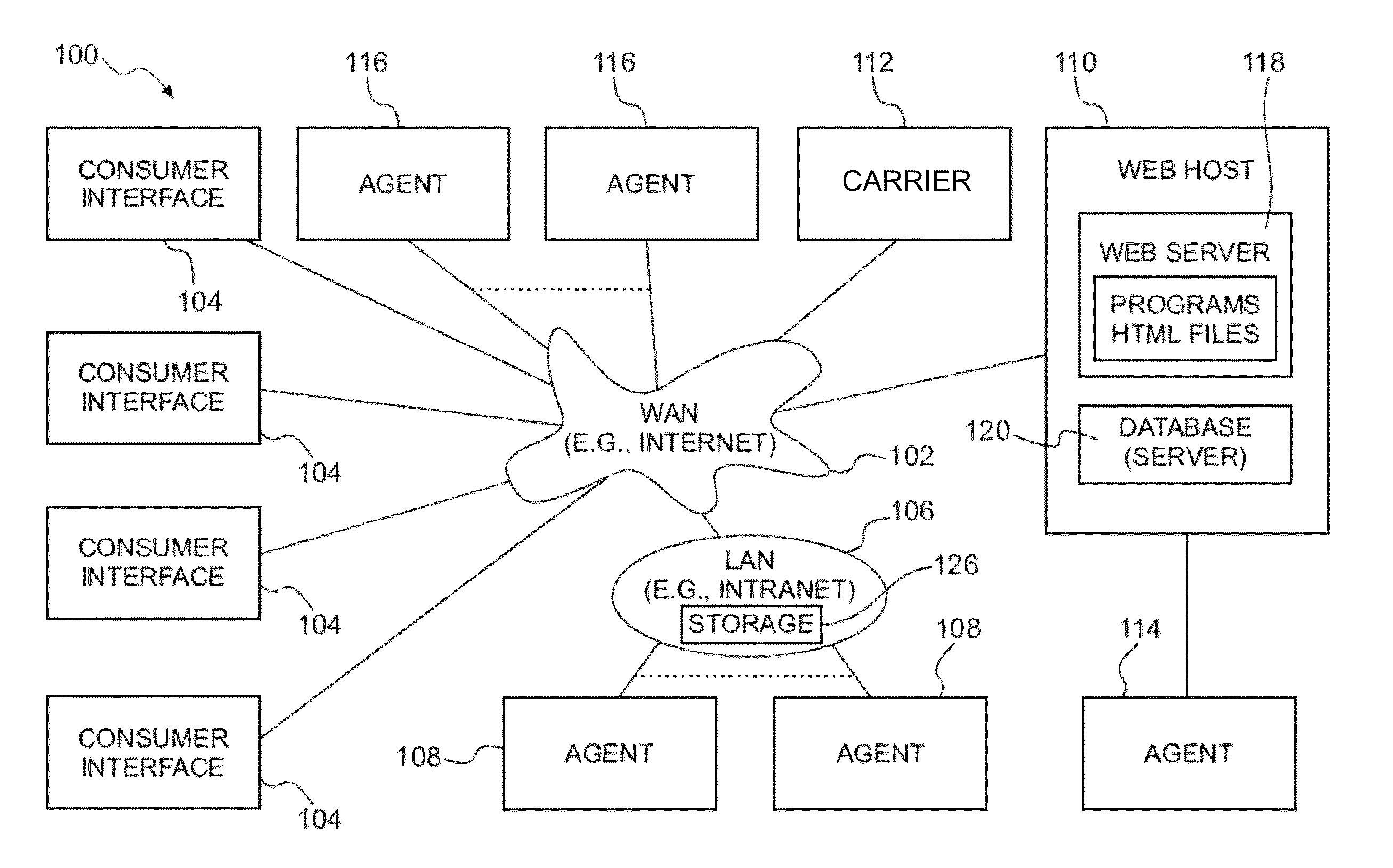

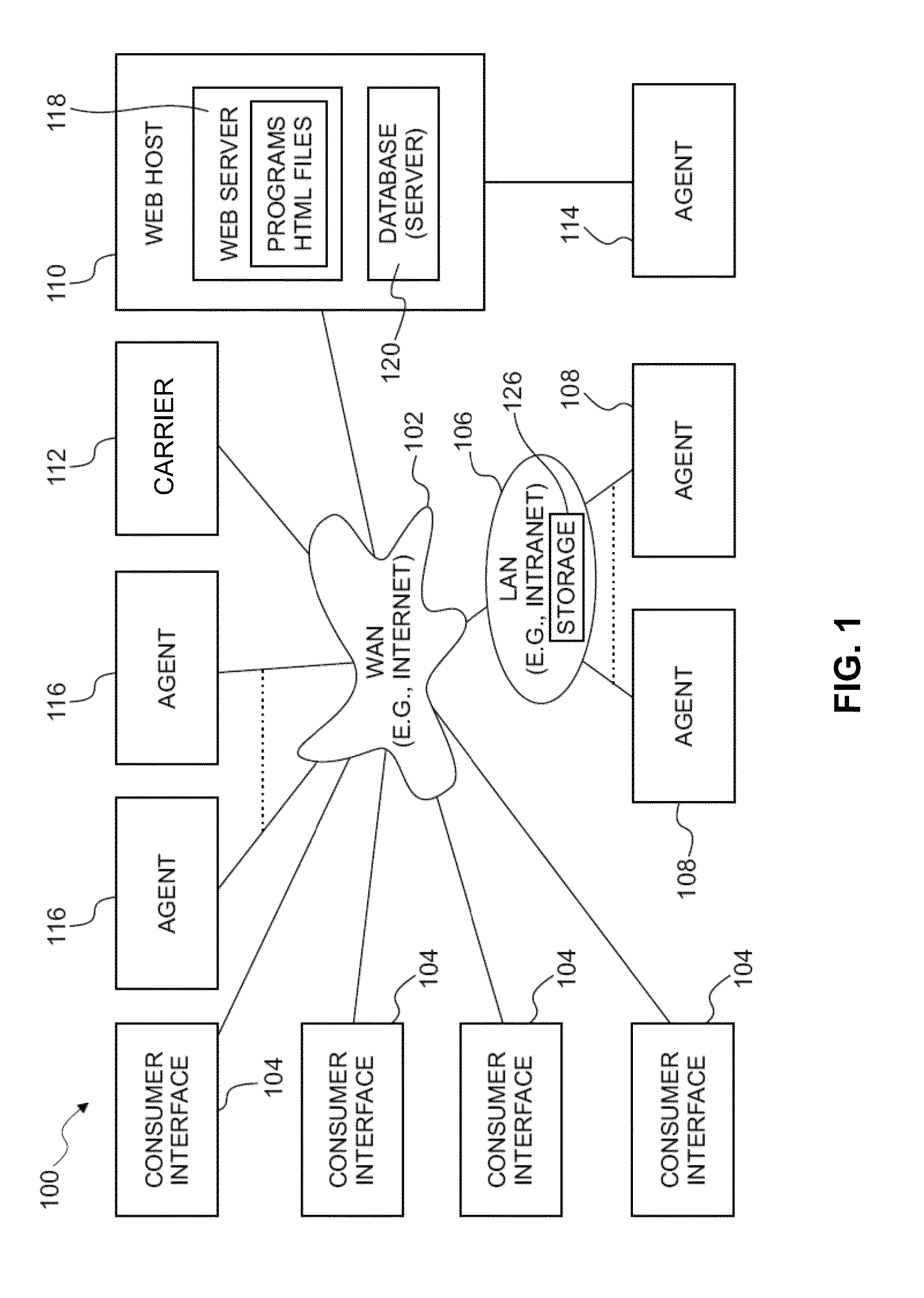

Interactive systems and methods for insurance-related activities

ActiveUS8185463B1Increase reflectionEasy to analyzeFinanceOffice automationInteraction systemsWeb browser

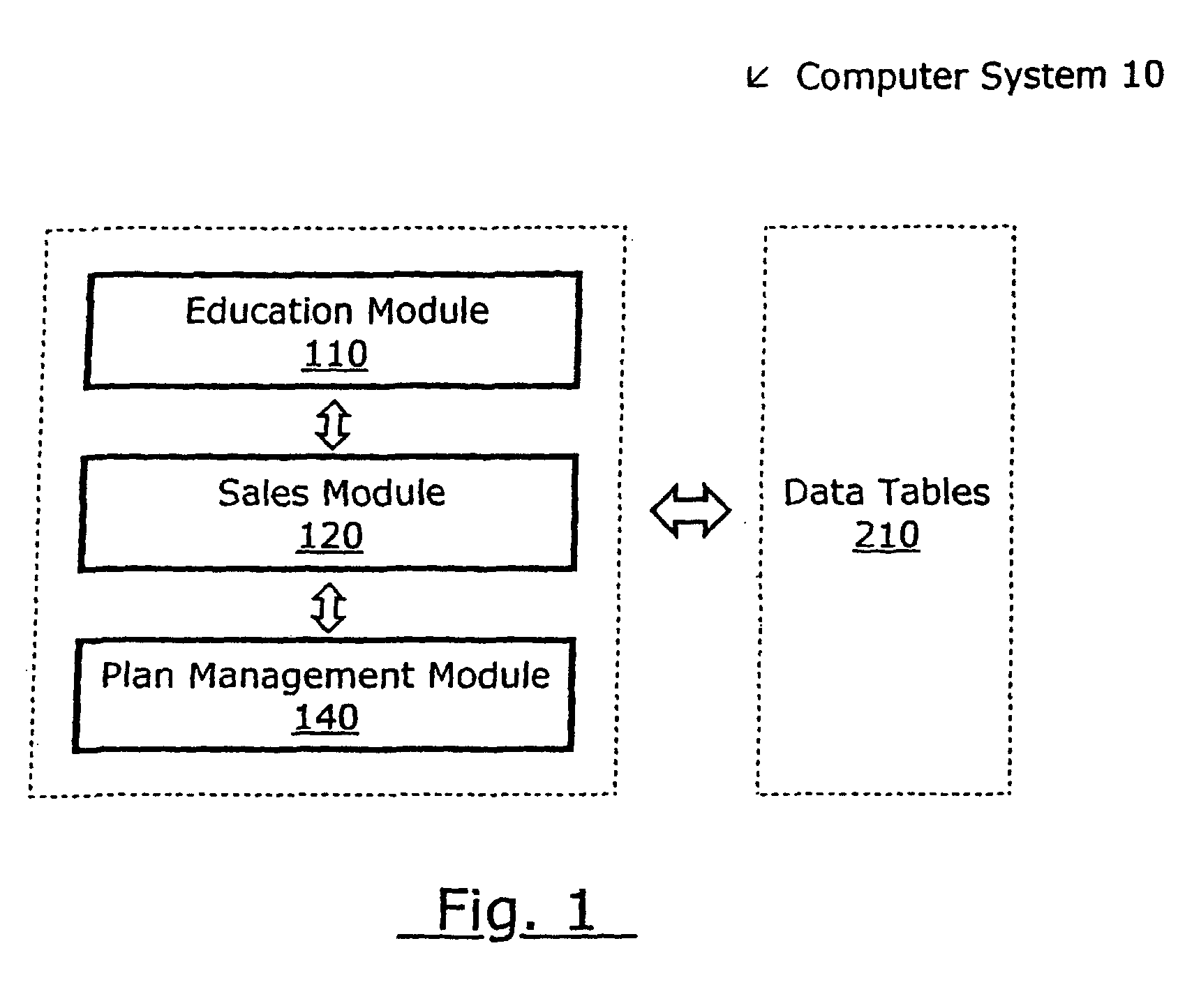

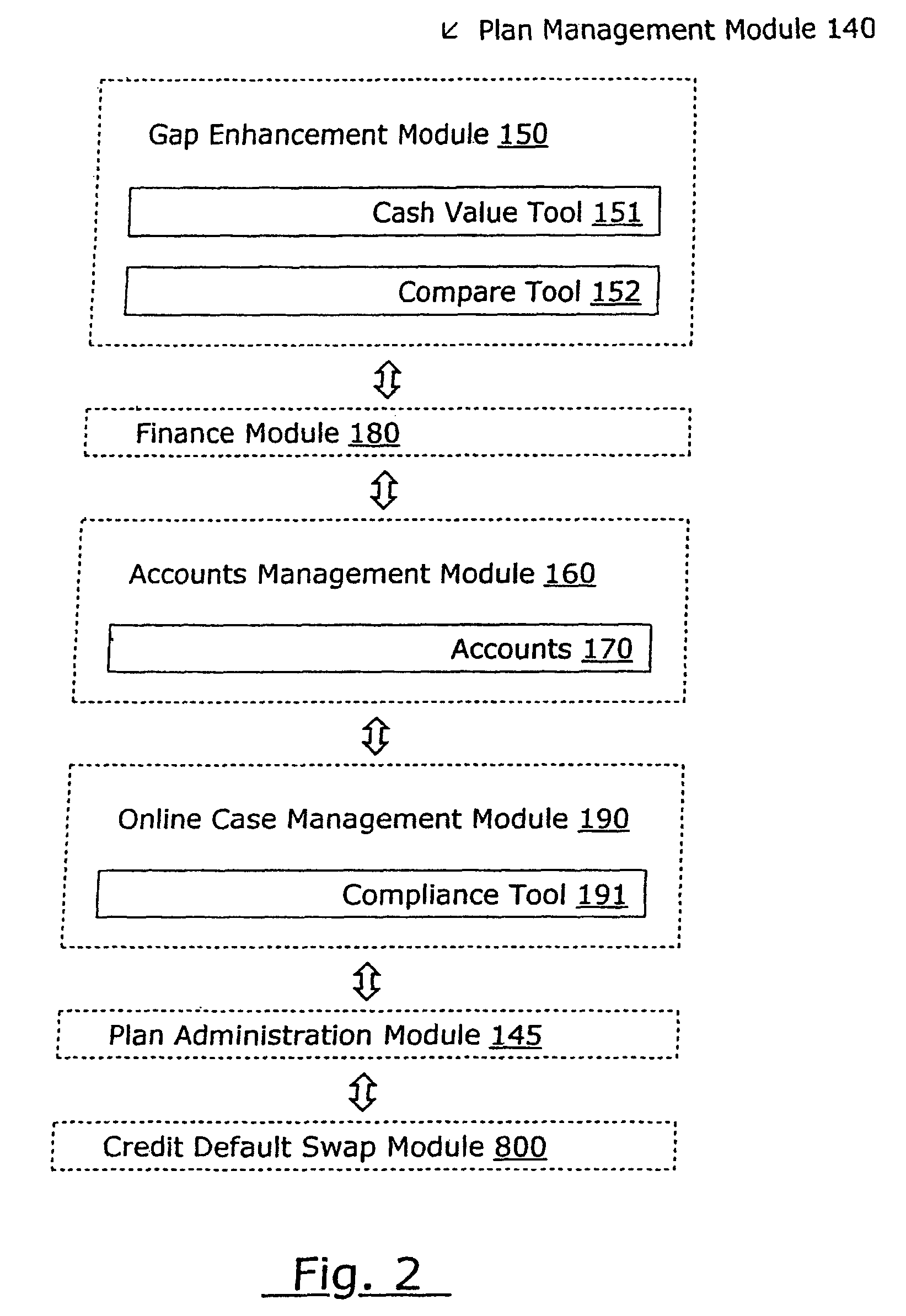

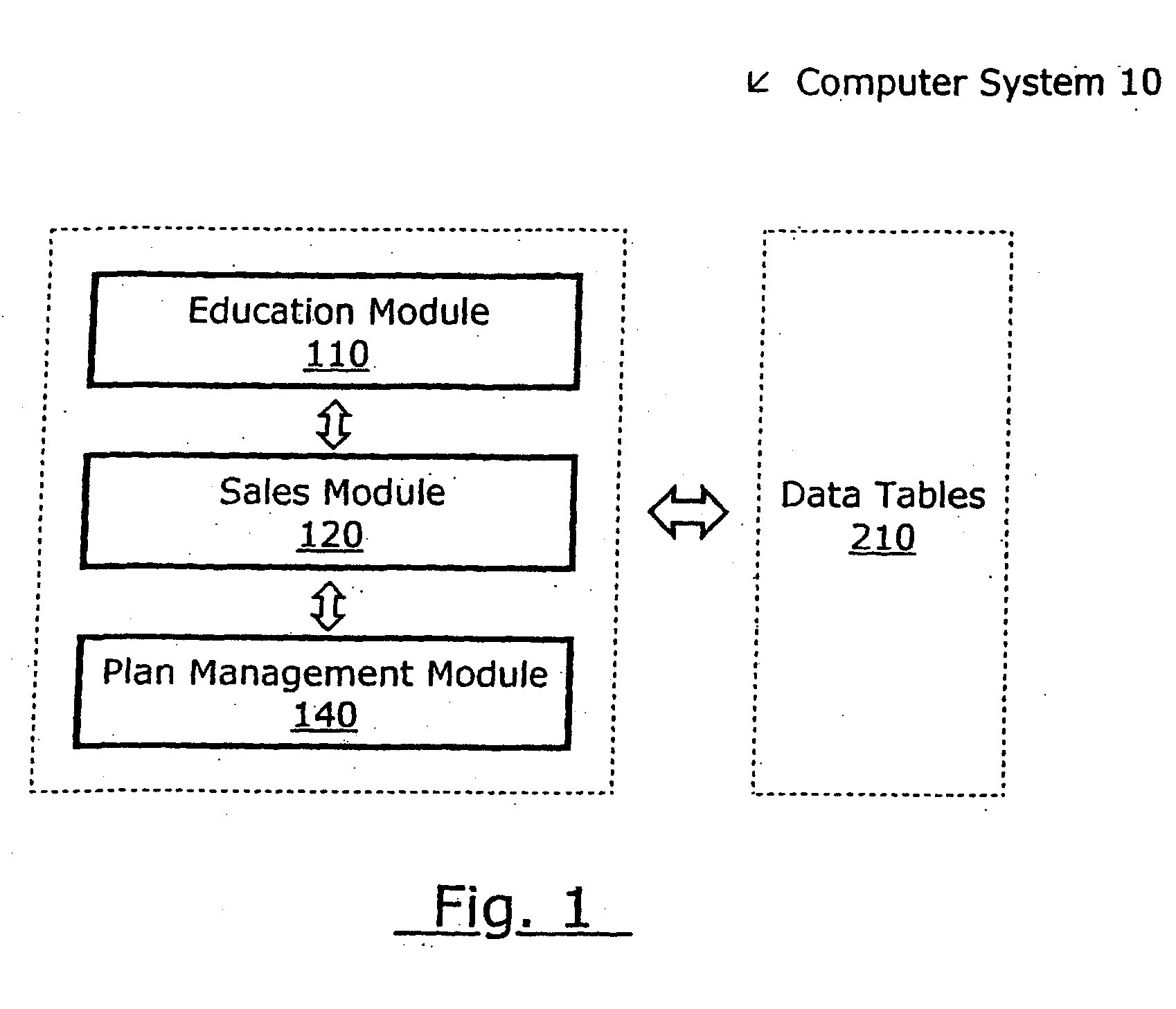

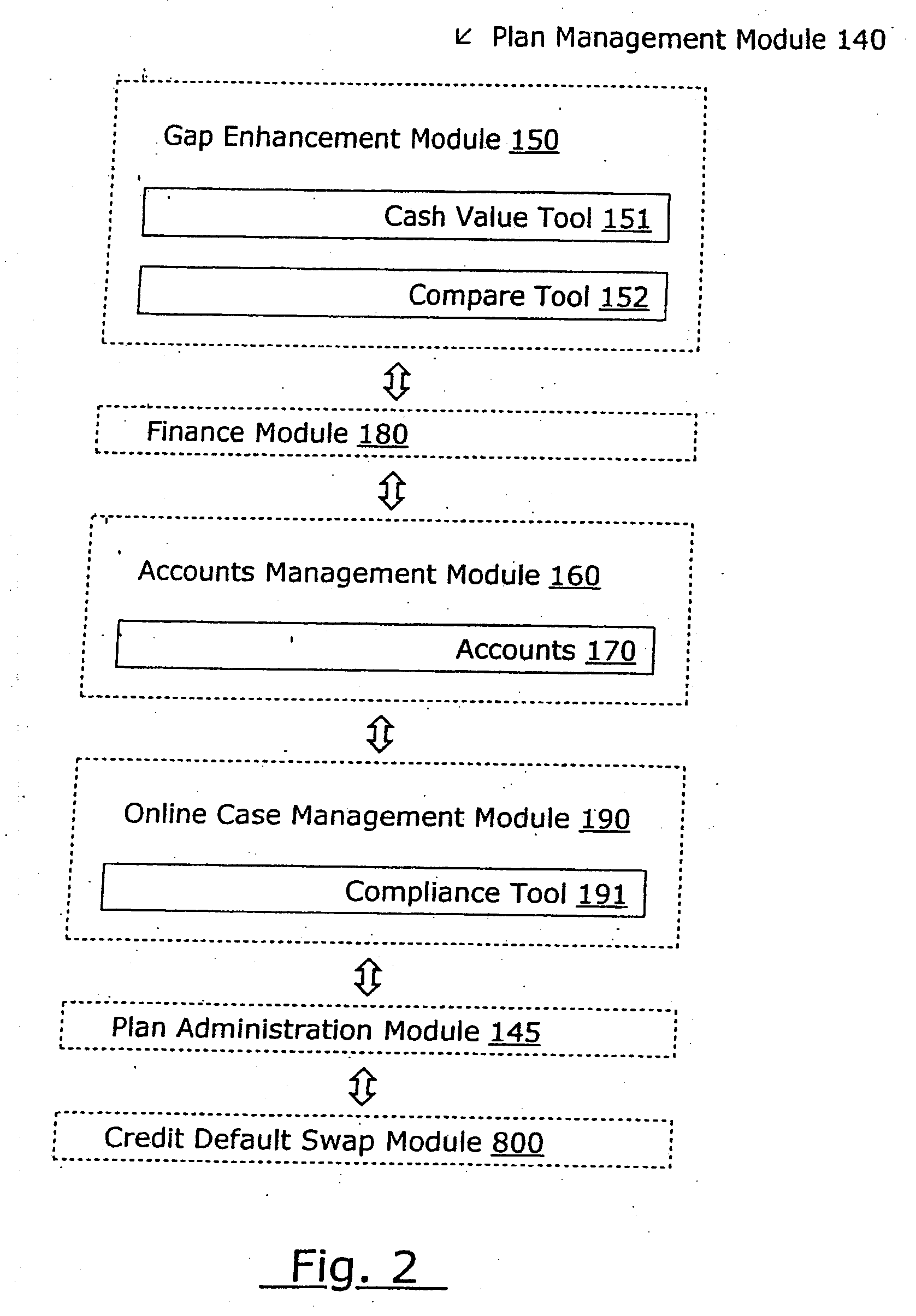

Systems and methods for performing insurance related activities are provided. Software can be implemented to provide an application that includes an interactive interface for use by insurance professionals in managing clients, marketing insurance, and storing information. For example, a network application can be implemented that a user can access via a web browser and which is intuitive for quick comprehension and interaction by users. The application can include multiple layers directed to particular stages of the insurance-client relationship. The application can include a Workflow Wizard® to aid the user in managing and maintaining client information and tracking progress. Aggregation services can also be incorporated into the application. Interactive insurance-and-client specific display pages can be incorporated to aid in understanding a client's current insurance information and to generate presentations. “Value” calculators may be implemented to illustrate a comparison of a client's current level of protection to a client's current financial state. Interactive tools for evaluating a customer's financial condition during retirement and how life insurance affects a customer's financial condition are also provided.

Owner:GUARDIAN LIFE INSURANCE COMPANY OF AMERICA

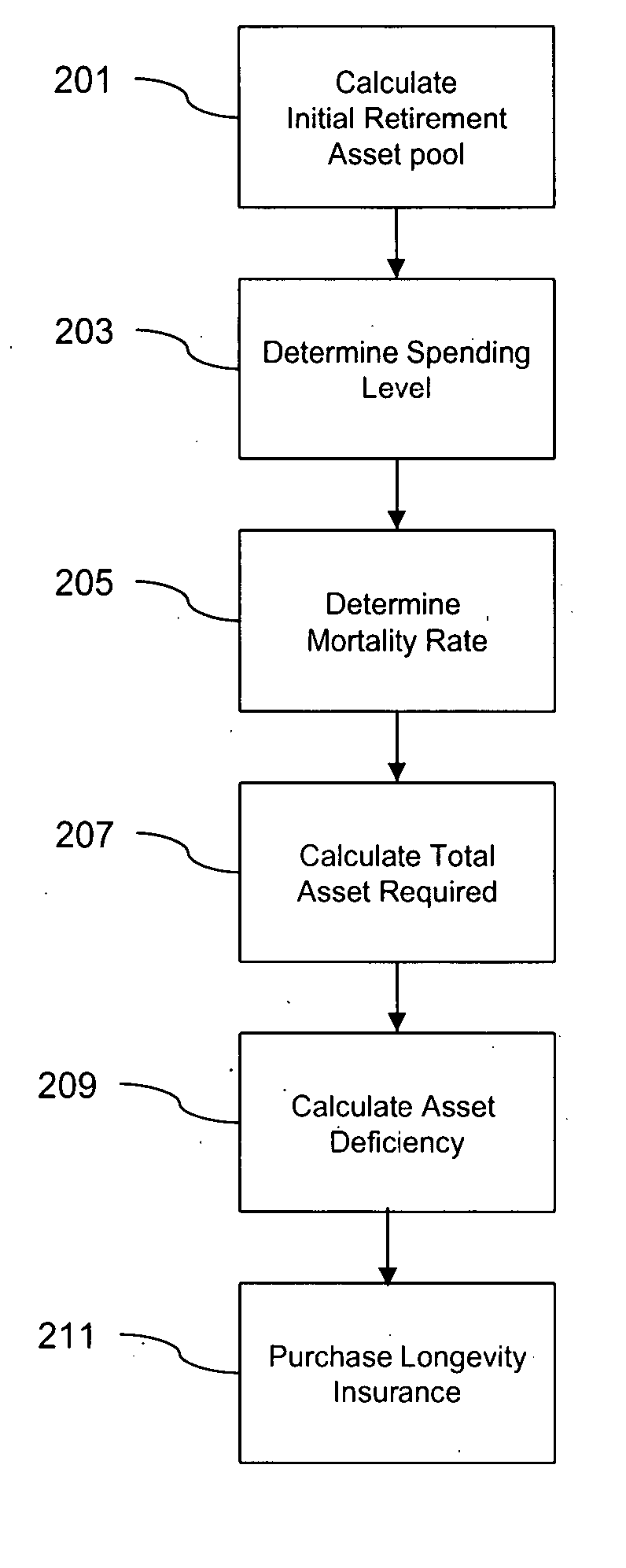

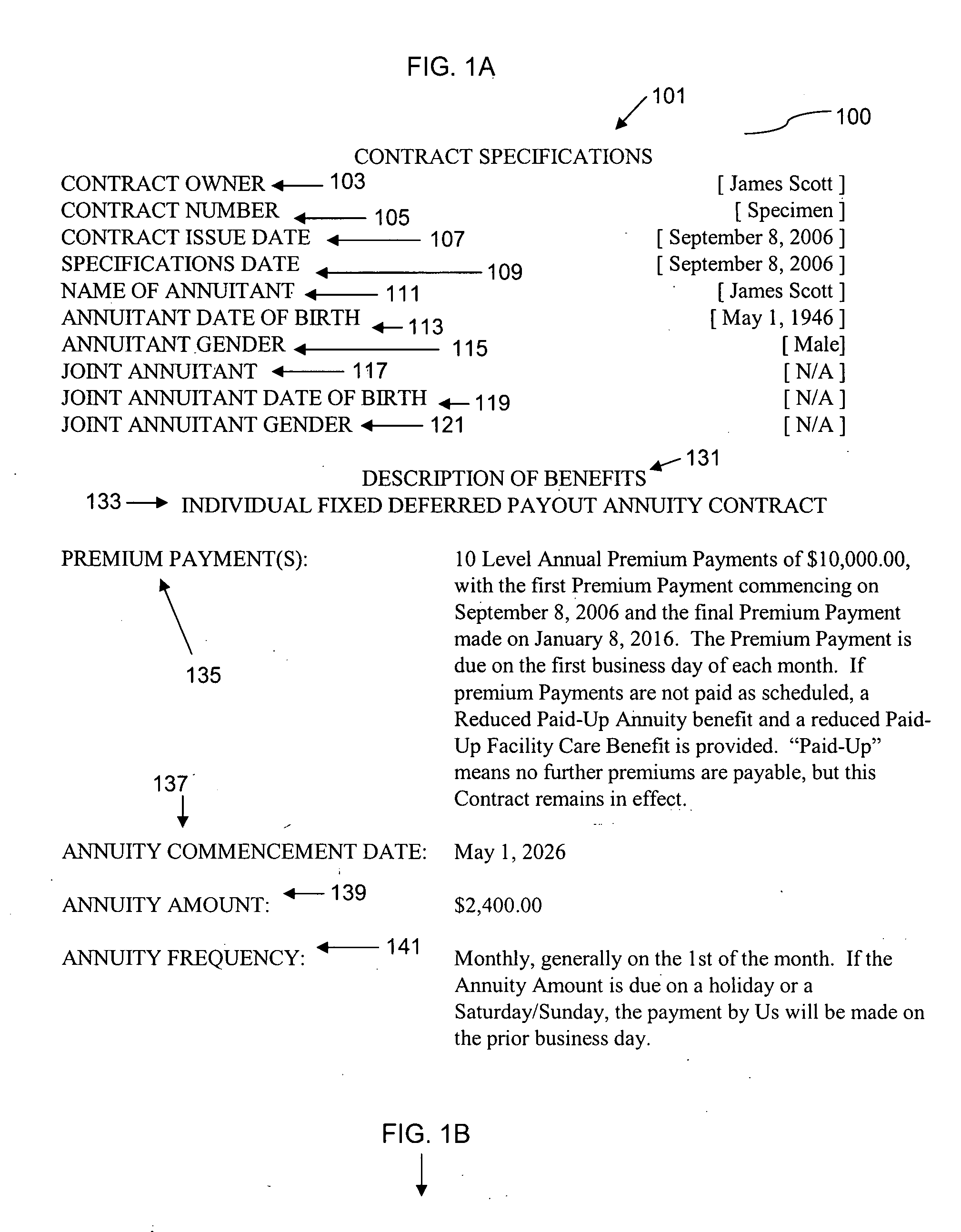

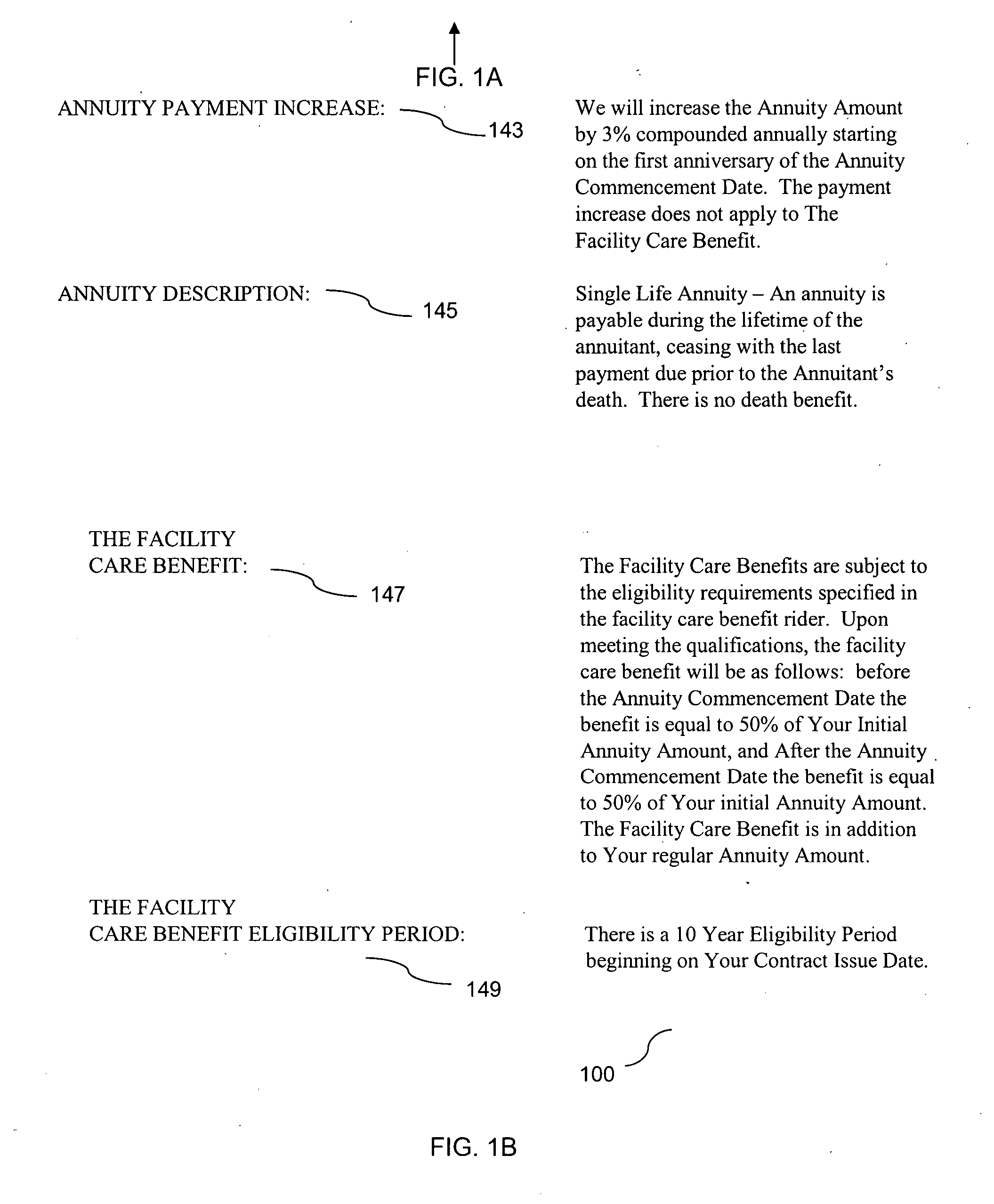

Longevity insurance

The present invention provides a life insurance product known as longevity insurance. Longevity insurance mitigates longevity risk, the risk that an individual will outlive his or her assets. More specifically, the purchase of longevity insurance guarantees an individual a predetermined, periodic income payment for the life of the purchaser. The guaranteed stream of monthly income commences at a later date, which may be utilized to supplement an existing income level or provide income in the event that the individual outlives his or her accumulated assets.

Owner:TALCOTT RESOLUTION LIFE INSURANCE CO

Method and apparatus for consumer interaction based on spend capacity

ActiveUS7912770B2Efficient use ofEfficient managementFinancePayment architectureCredit cardData source

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

System and method for creating a retirement plan funded with a variable life insurance policy and/or a variable annuity policy

A retirement plan is created using variable life insurance contracts and / or variable annuity contracts. Actuarial data used to create the retirement plan is entered via at least one user interface and processed. Based on the actuarial data, a variable life insurance policy and / or a variable annuity policy is generated for the purpose of funding the retirement plan. Additionally, a separate agreement is created that either extra-contractually modifies the variable life insurance policy and / or the variable annuity policy, or defines the terms under which the variable life insurance policy and / or the variable annuity policy is to be used in the retirement plan.

Owner:KORESKO JOHN J V

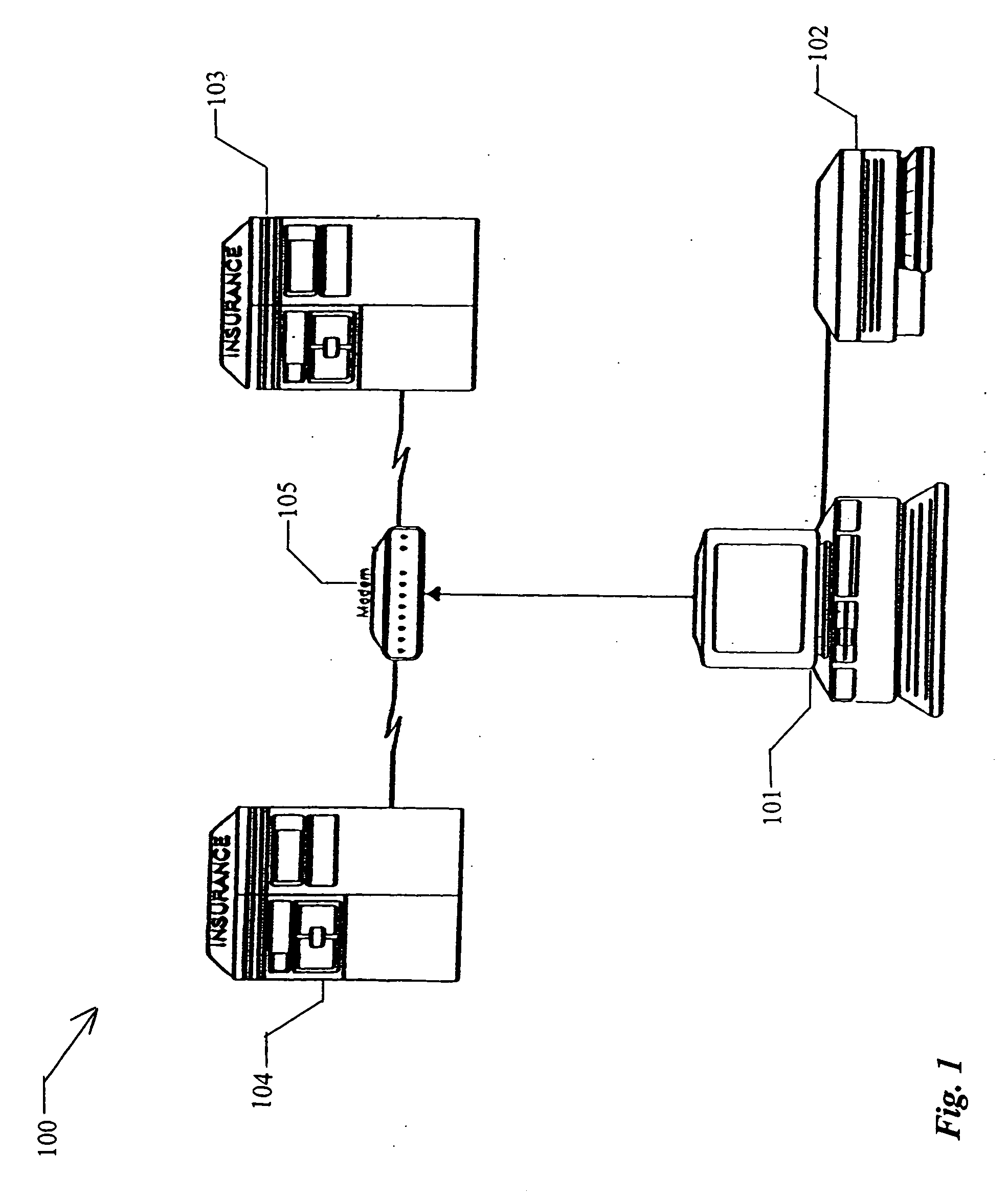

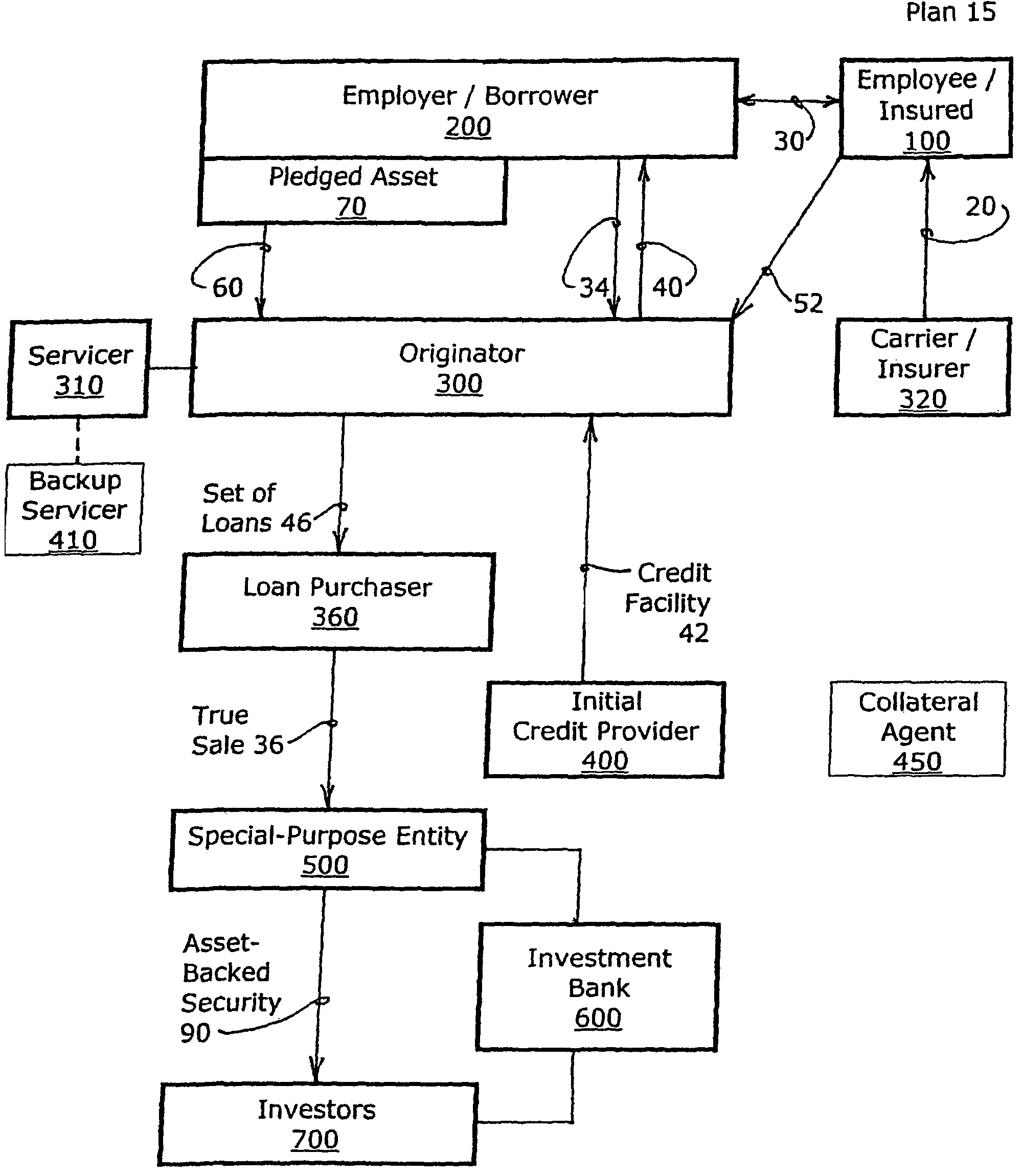

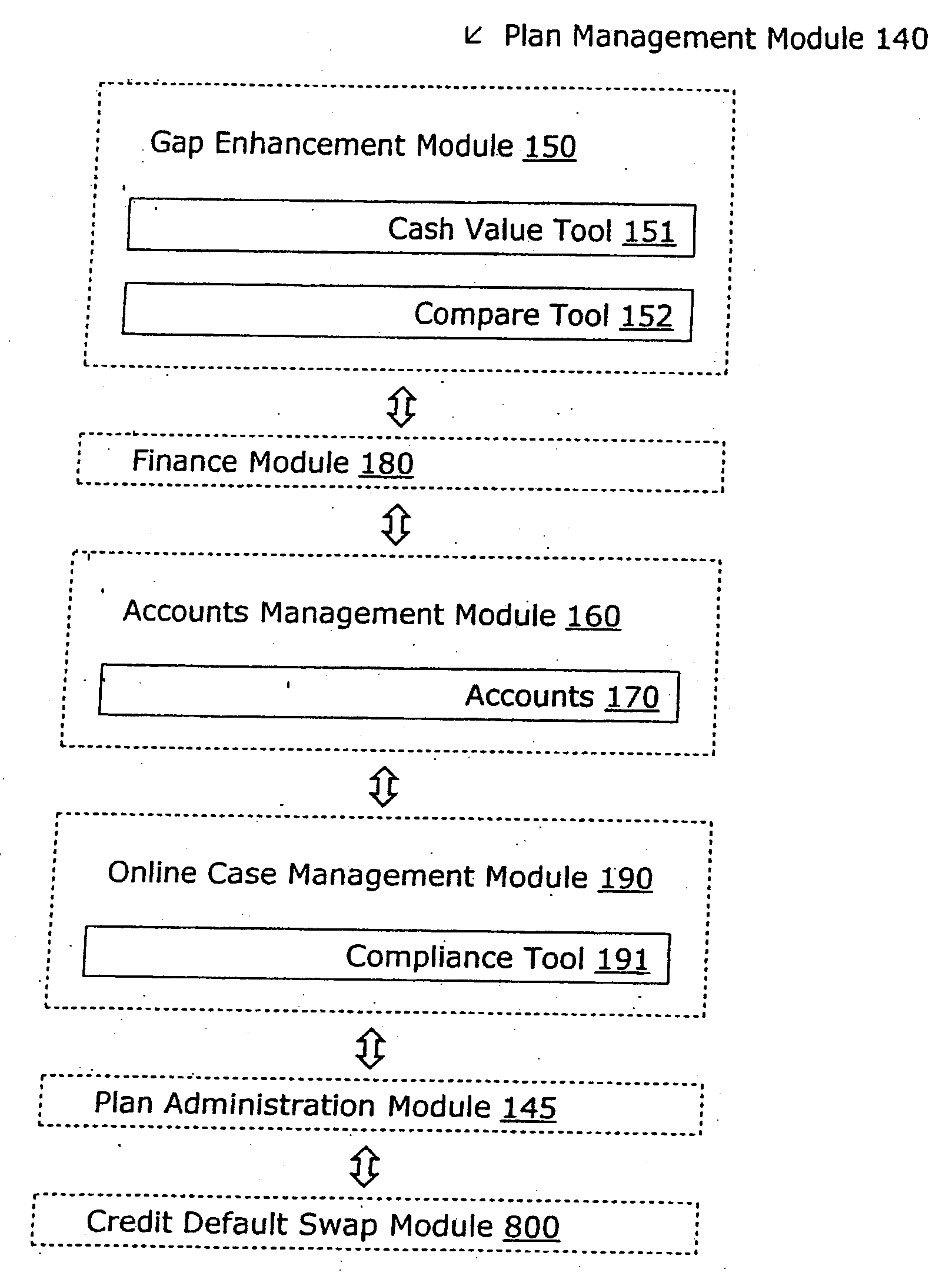

System for managing the total risk exposure for a portfolio of loans

A computer system for monitoring and enhancing the collateral security underlying a set of loans is provided, including a system for calculating the unsecured value of the set at any time and for initiating additional collateral enhancement instruments when the unsecured value exceeds a certain limit. The system may include a variety of modules in communication with a relational database for storing data about the loans and system elements. The computer system may also be configured to allocate, manage, and execute the waterfall or cascade of funds between and among the various participants in a financial plan. The invention also includes a structured finance plan and related methods for enhancing the collateral security of a loan obtained for a life insurance or annuity product, and a system and method for managing a portfolio of such loans in order to obtain favorable financing and to facilitate securitization.

Owner:ENTAIRE GLOBAL INTPROP

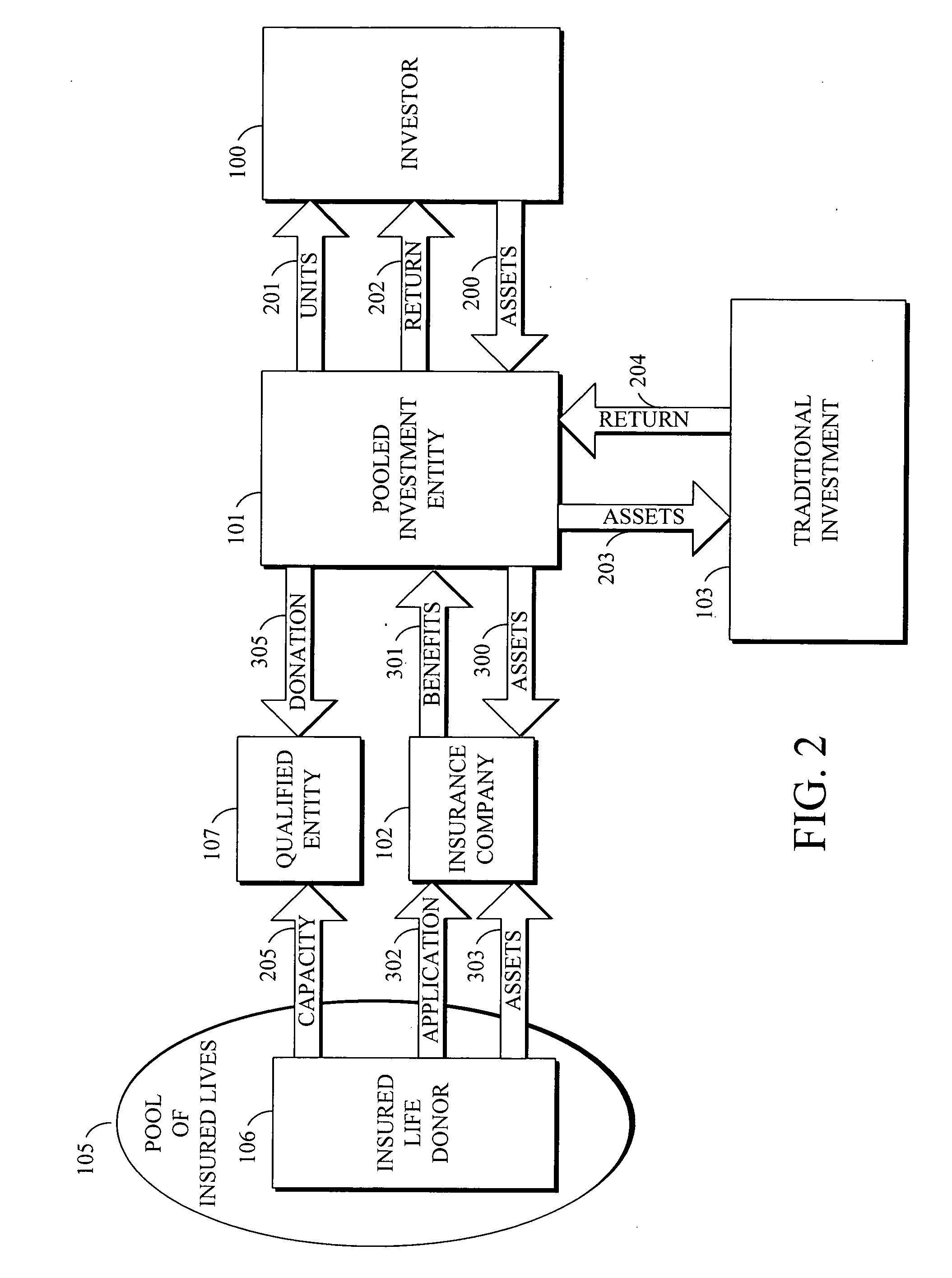

Apparatus and method for achieving enhanced returns on investments

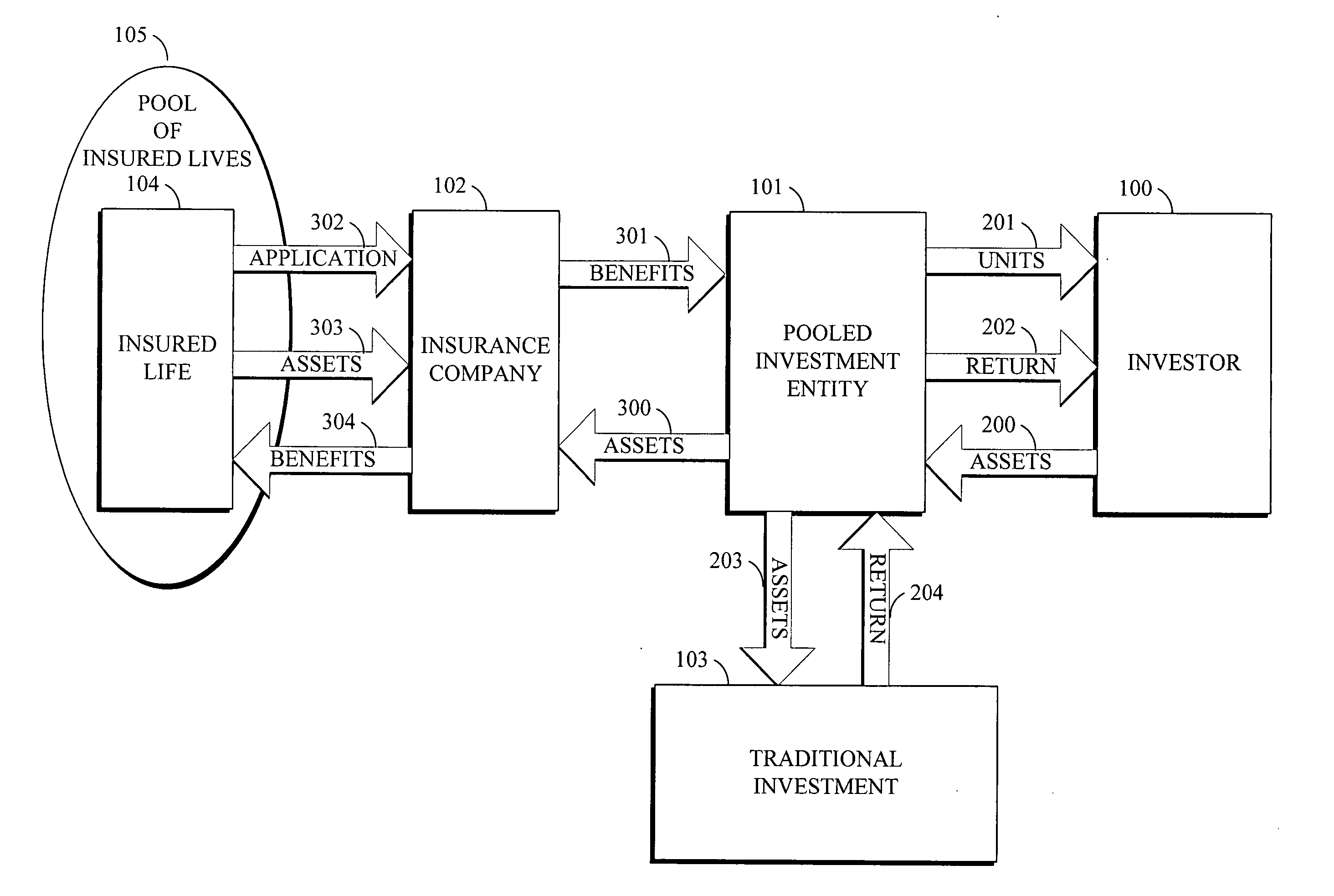

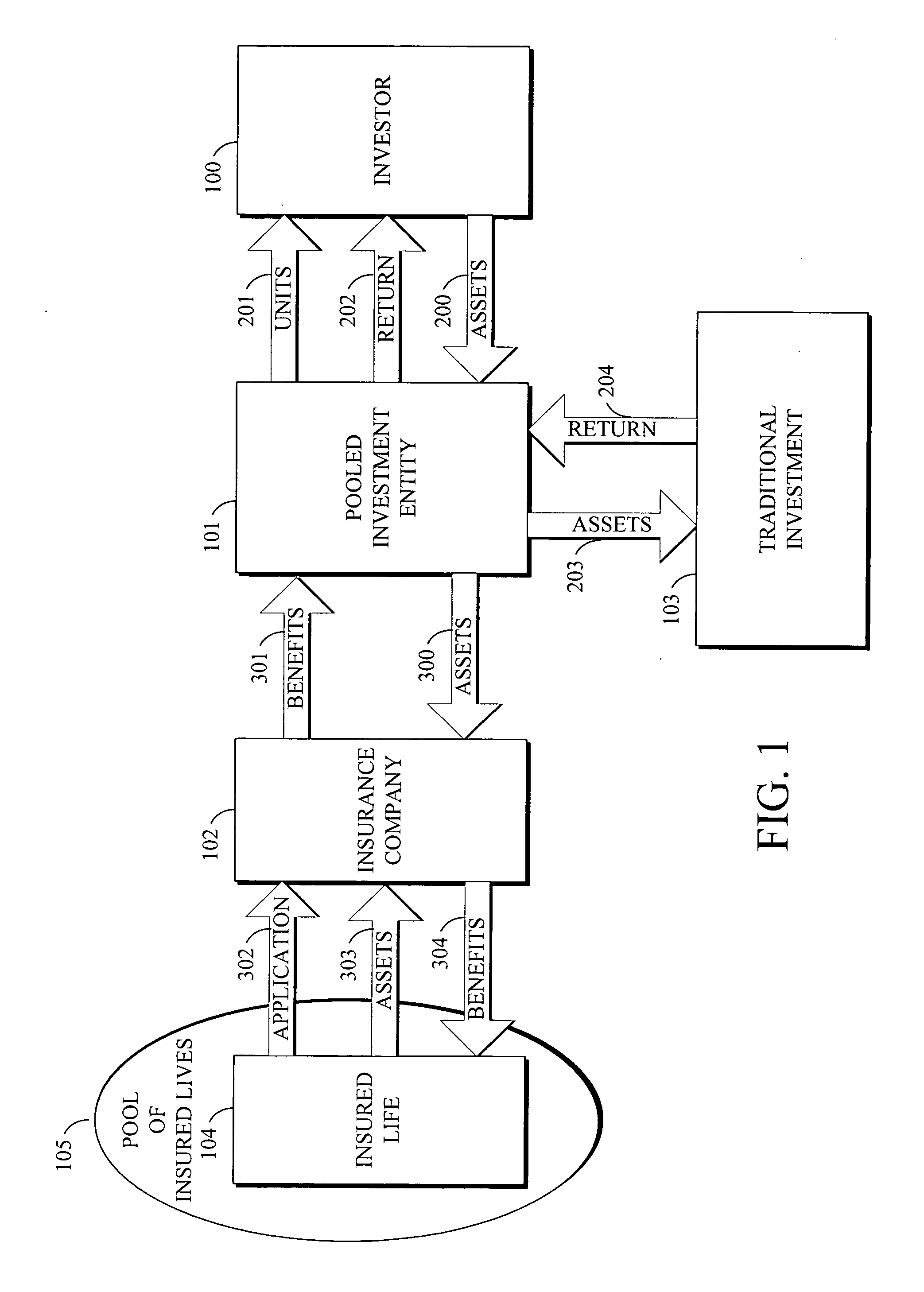

The apparatus and methods of the present invention create enhanced investment returns for investors by utilizing standard insurance products and recognizing the actuarial expectation of death for lives within a pool of insured lives. In the most preferred embodiments of the present invention, a pooled investment entity, which is a tax "pass through" entity, invests in life insurance policies or otherwise secures life insurance policies placed on lives in a pool of insured lives. A projected return is calculated on an actuarial basis and actual returns are paid based on the experience of deaths in the pool of insured lives.

Owner:GOLDER MELICK

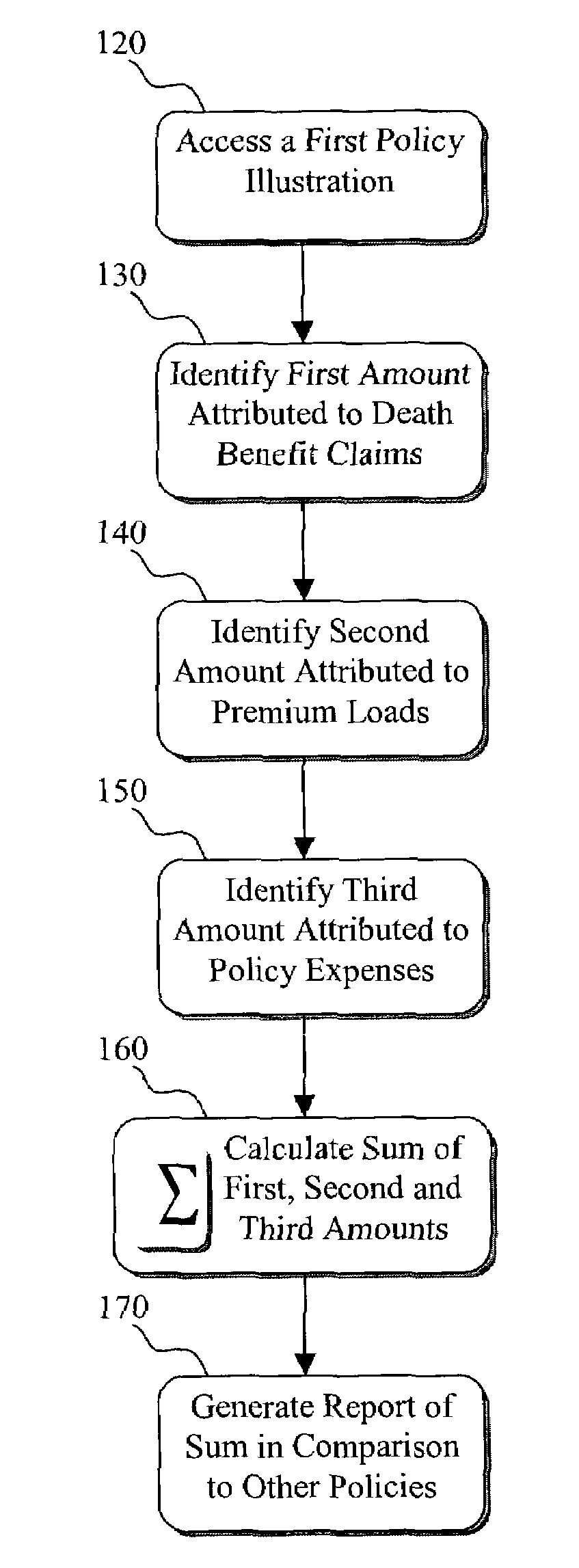

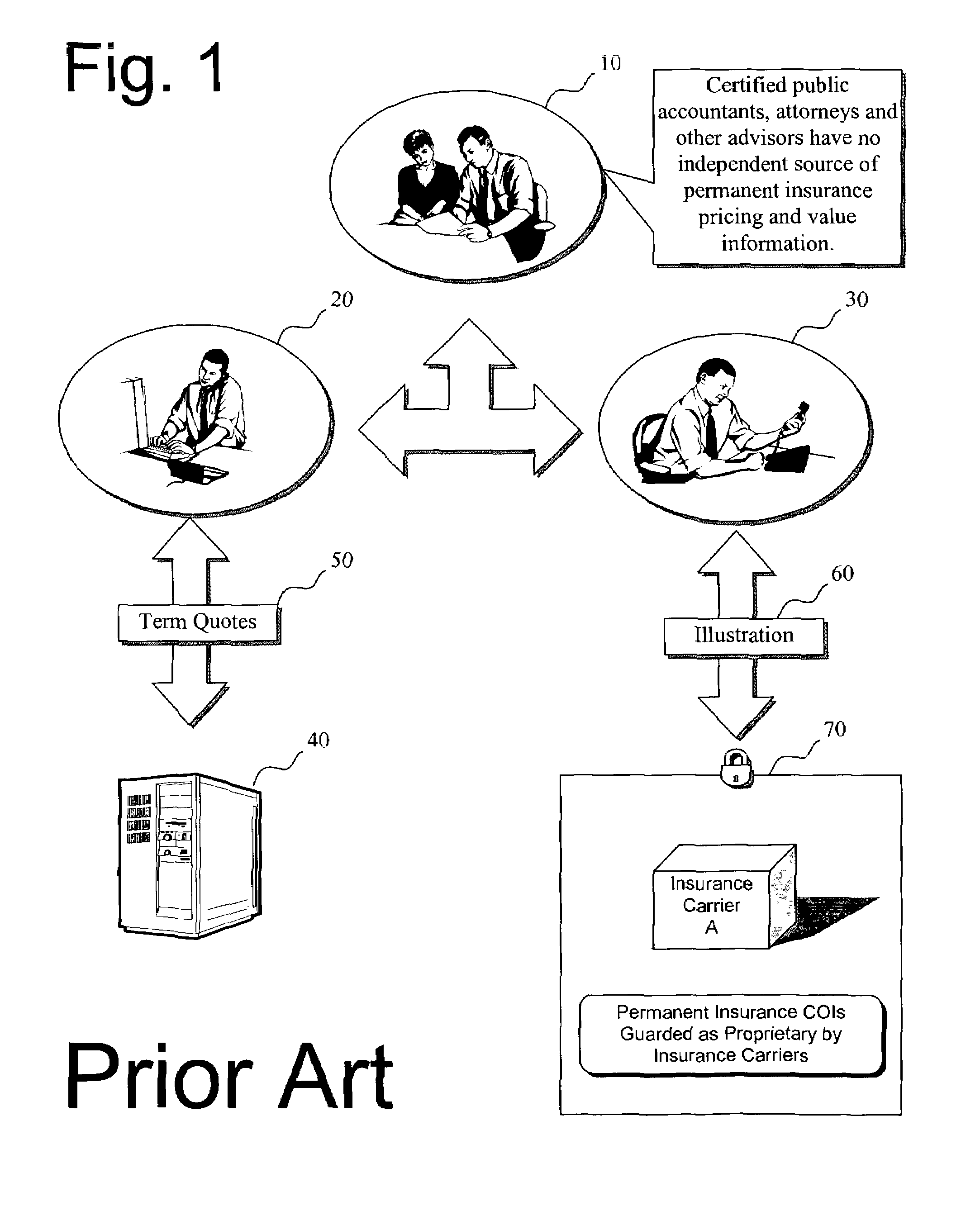

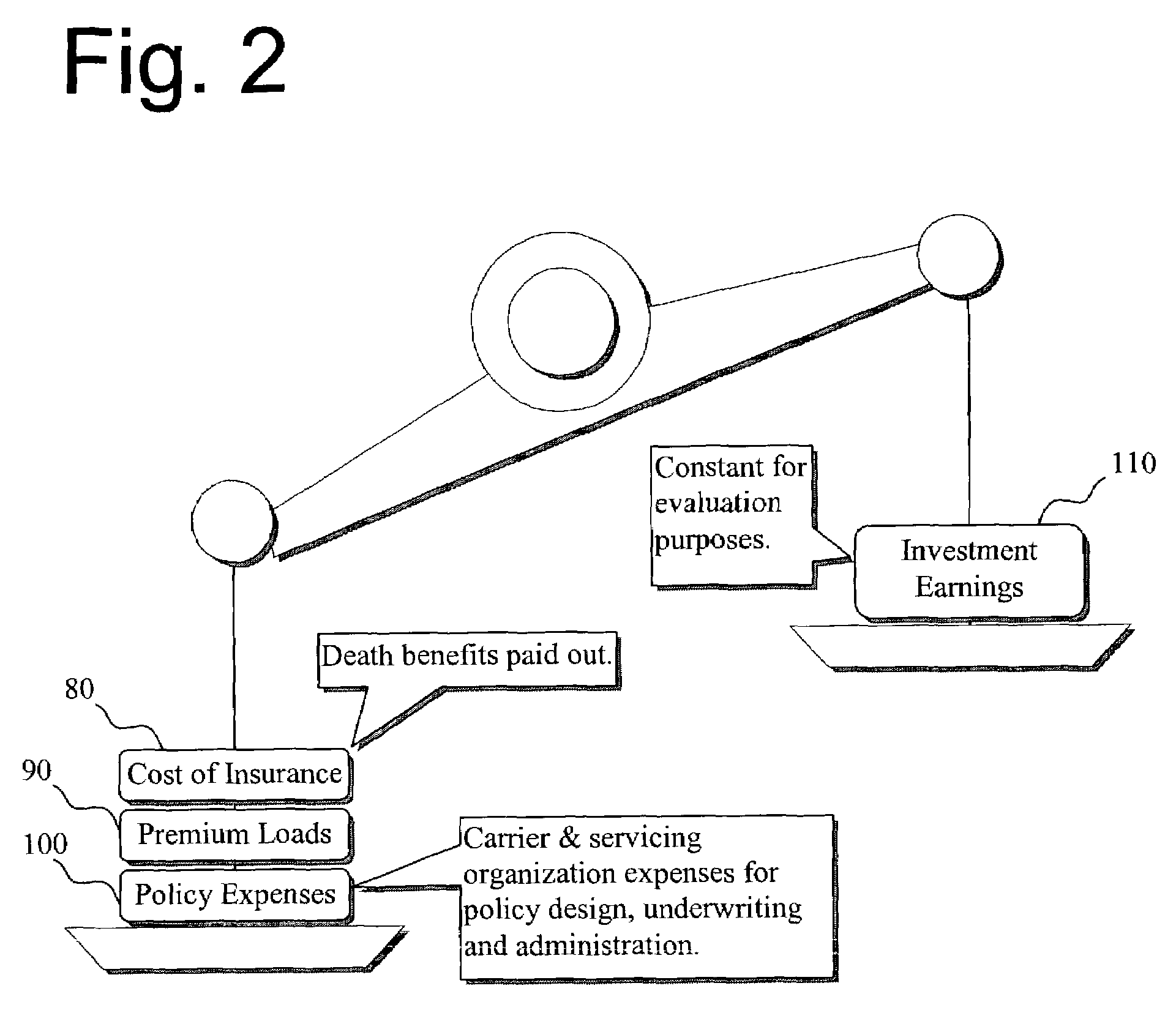

Life insurance policy evaluation method

A method of evaluating a permanent life insurance policy including the steps of accessing a policy illustration, establishing an effective life span of the policy illustration, identifying a first amount attributed to death benefit claims, identifying a second amount attributed to premium loads, identifying a third amount attributed to policy expenses, calculating a sum of the first, second and third amounts for a plurality of policy years, averaging the sum for each year throughout the effective life span, calculating a cash value of the policy illustration for the plurality of policy years, identifying a projected investment earnings forecast in the policy illustration, normalizing the projected investment earnings forecast, adding the project investment earnings to the cash value, and recalculating the current cash value of the policy illustration for the plurality of policy years.

Owner:THEINSURANCEADVISOR TECH

Method for determining insurance benefits and premiums from credit information

The invention is a method of obtaining credit life insurance for an individual by means of a service organization. In detail, the steps include: 1) registering the individual with the service organization via a computer system in a computer network; 2) accessing credit information on the individual by means of the computer system in the computer network and determining the total debt of the individual; 3) determining the amount of debt to be covered by credit life insurance benefits; 4) creating a data base including insurance companies that provide credit life insurance benefits, the data base further including the premiums that the insurance companies charge for issuing their credit life insurance; 5) selecting specific coverage with required specific premiums; 6) obtaining the individual's approval of the required specific premiums via the computer system in the computer network; and 7) obtaining credit life insurance benefits for the individual.

Owner:CONSUMERINFO COM

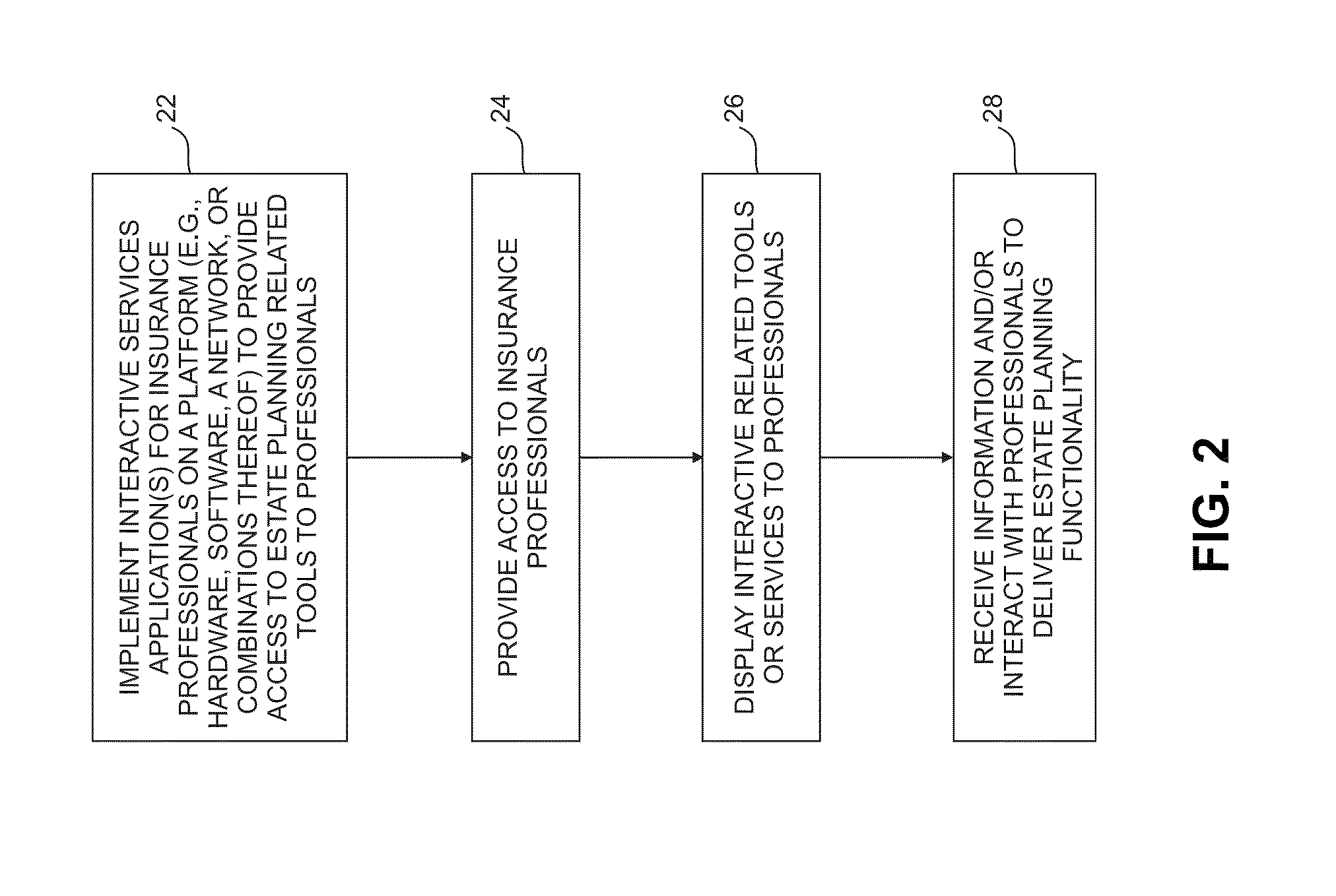

Interactive systems and methods for estate planning related activities

Systems and methods for performing insurance related activities are provided. Software can be implemented to provide a (optionally networked) application that includes an interactive interface for use by insurance professionals in managing clients. Personal data can be received for computing a client's financial condition. Business data of the client can be received for computing a business financial condition of the business at the death of the client. An assumption of the business financial condition, including levels of business owned life insurance can be modified. A selection mechanism can also be provided, which when selected displays a representation of a death benefits to the client and to the business, based on the modified assumption. The personal financial and business financial condition can change in relation to a change in the personal death and business death benefit as the assumptions are interactively modified, thereby showing the benefit of business owned life insurance.

Owner:GUARDIAN LIFE INSURANCE COMPANY OF AMERICA

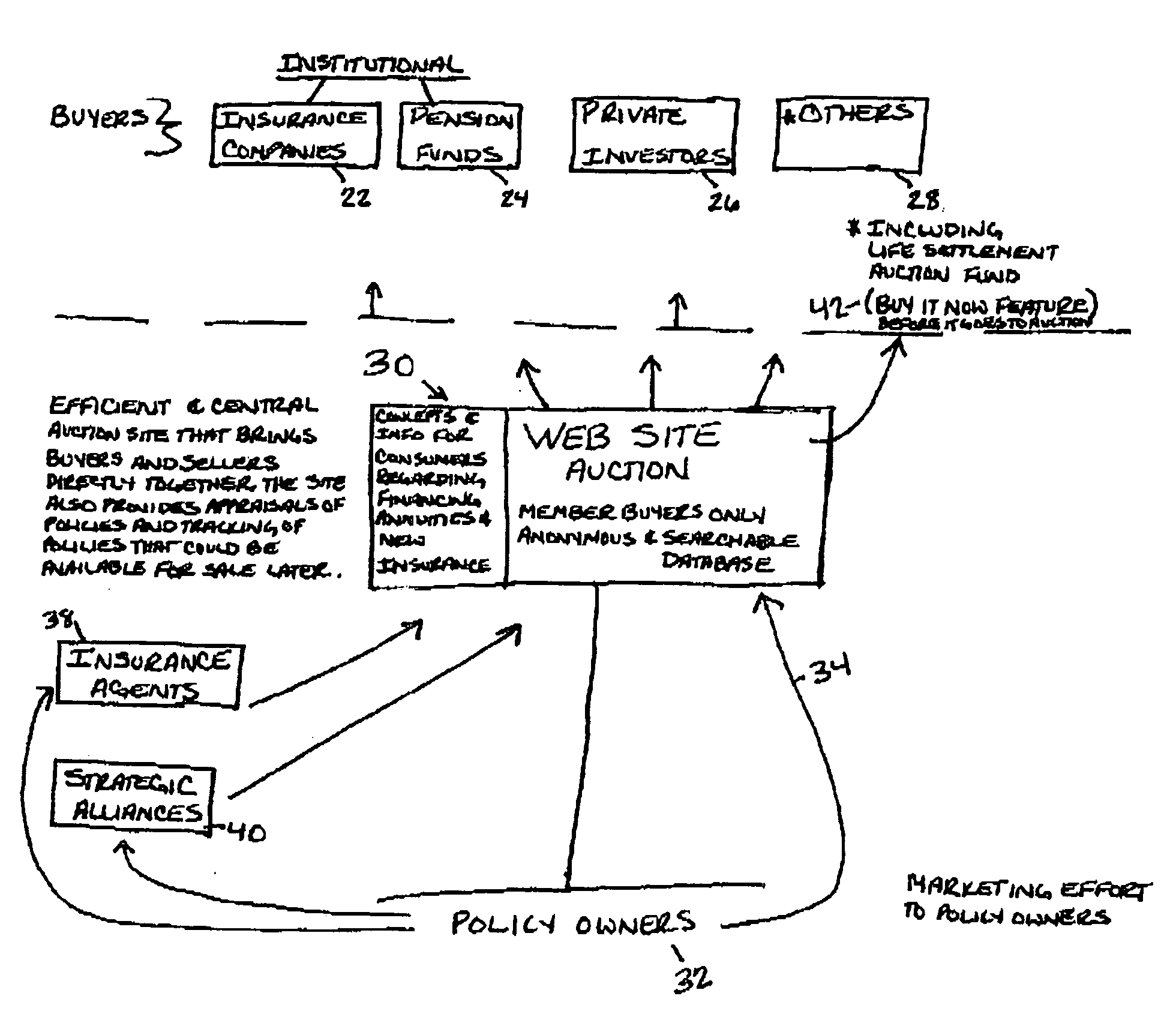

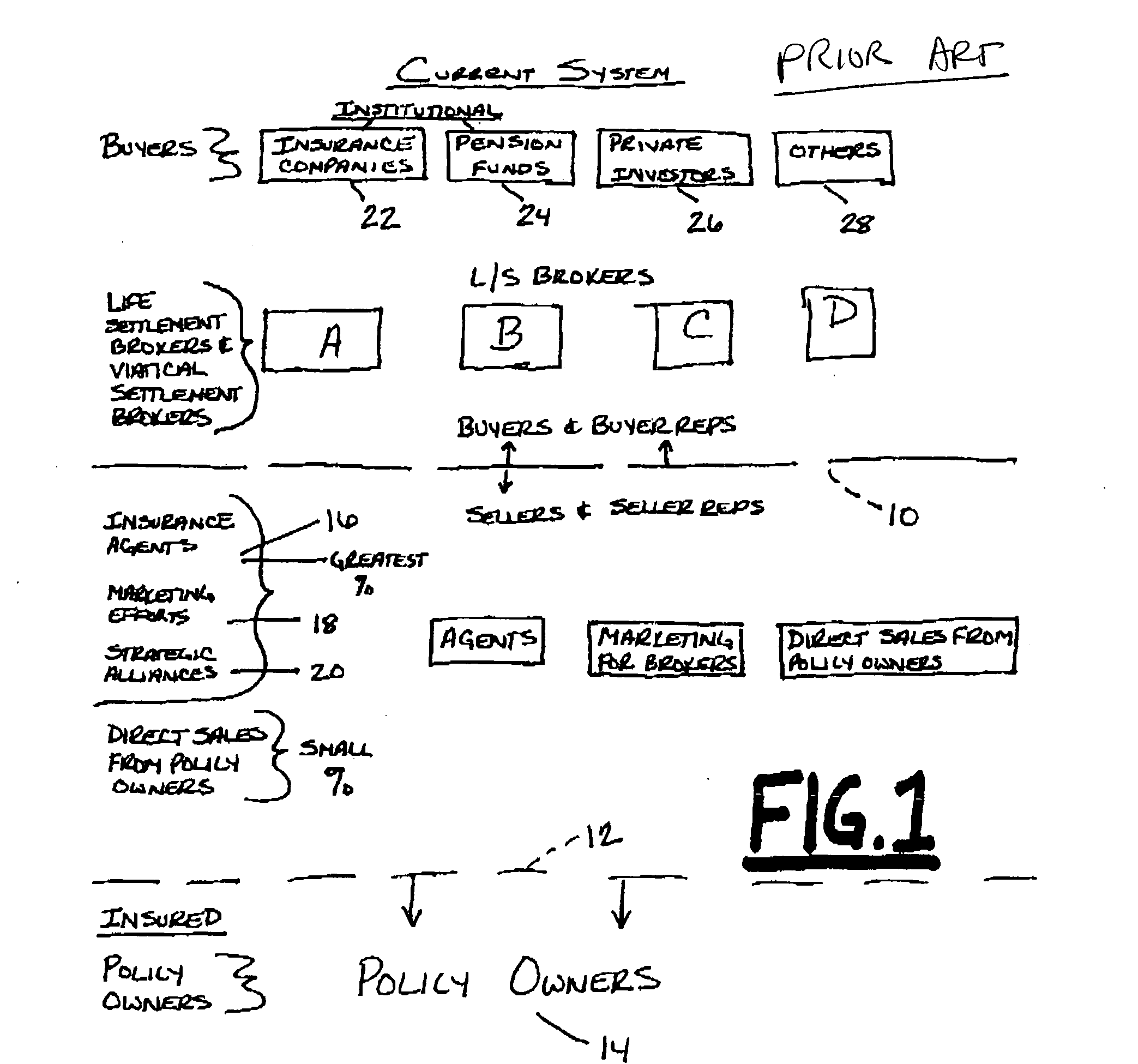

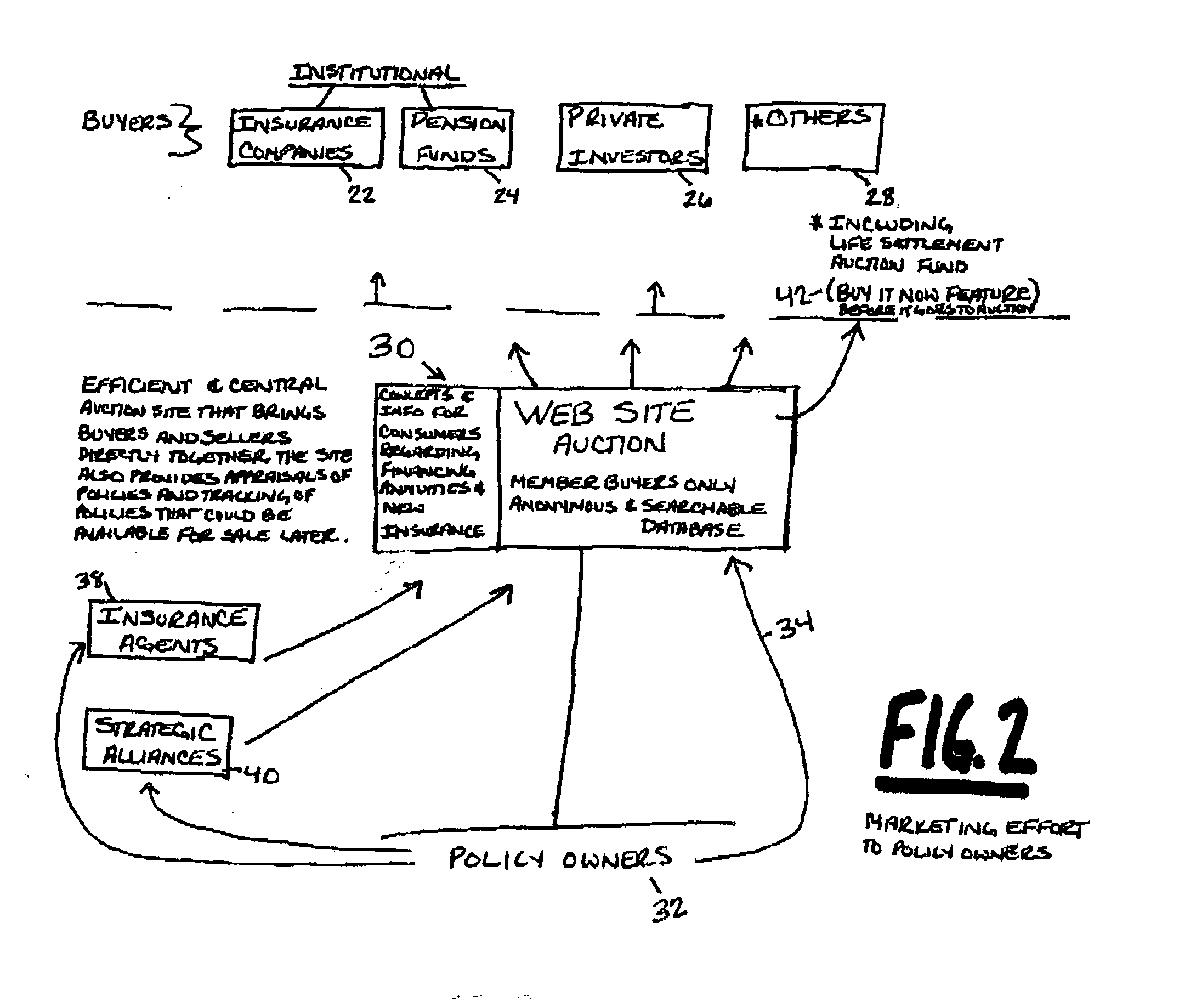

System for facilitating life settlement transactions

A system and method for buying and selling life insurance policies includes an online database for storing information concerning in-force policies as needed for evaluation by a potential buyer. Owners of policies, either directly or through agents, who might be willing to sell their policies, register with the online website with critical financial and medical underwriting information relating to their policies, as needed for evaluation by a potential buyer. In the online database such information is organized and categorized as to parameters of various medical and financial information, to be reviewed online in an orderly manner by investors and potential buyers of policies. A membership preferably is required for a potential buyer to have access to the online information. In a preferred implementation of the system, an auction is held online to obtain essentially the best price for each policy.

Owner:POLICYAUCTION COM

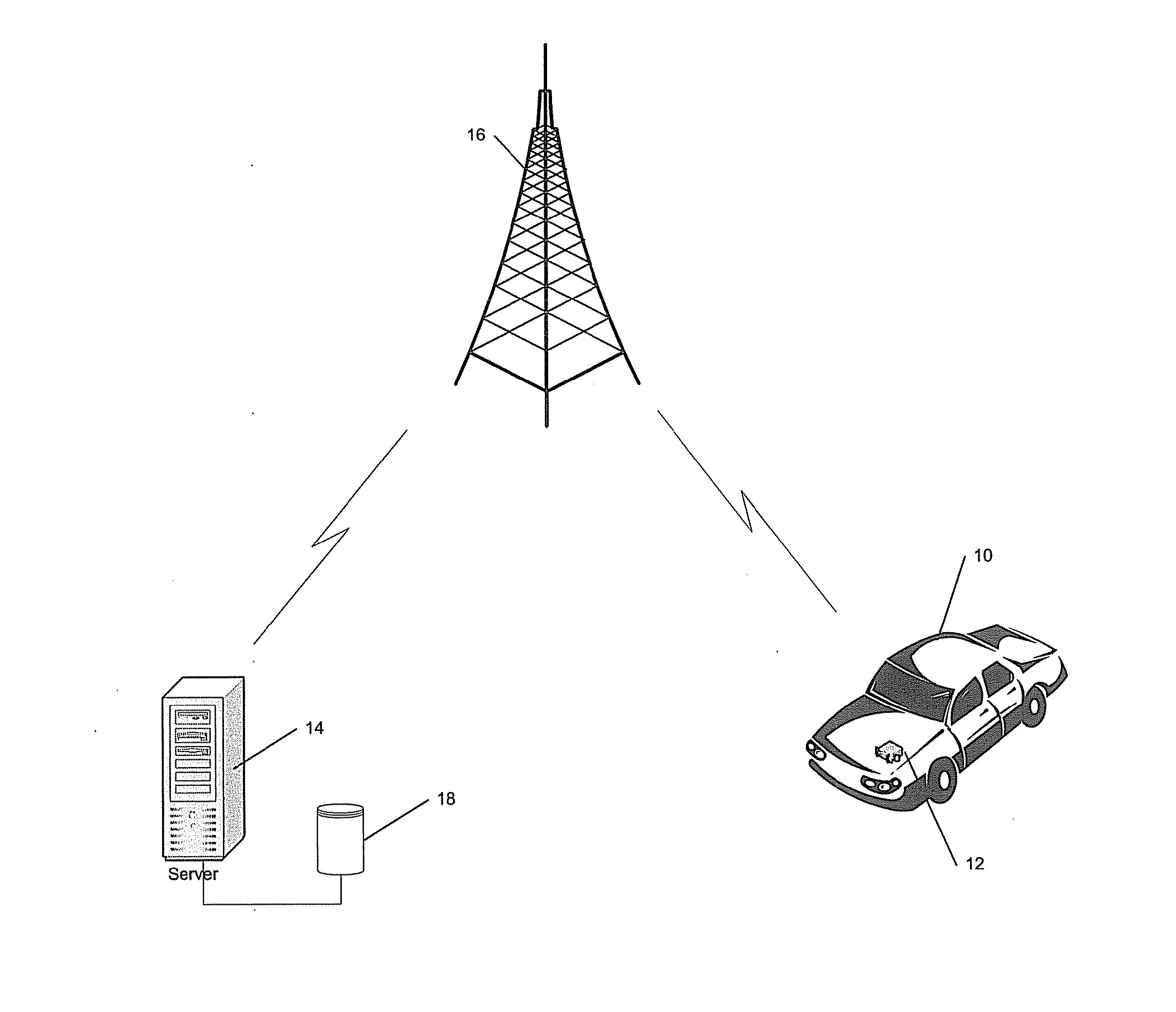

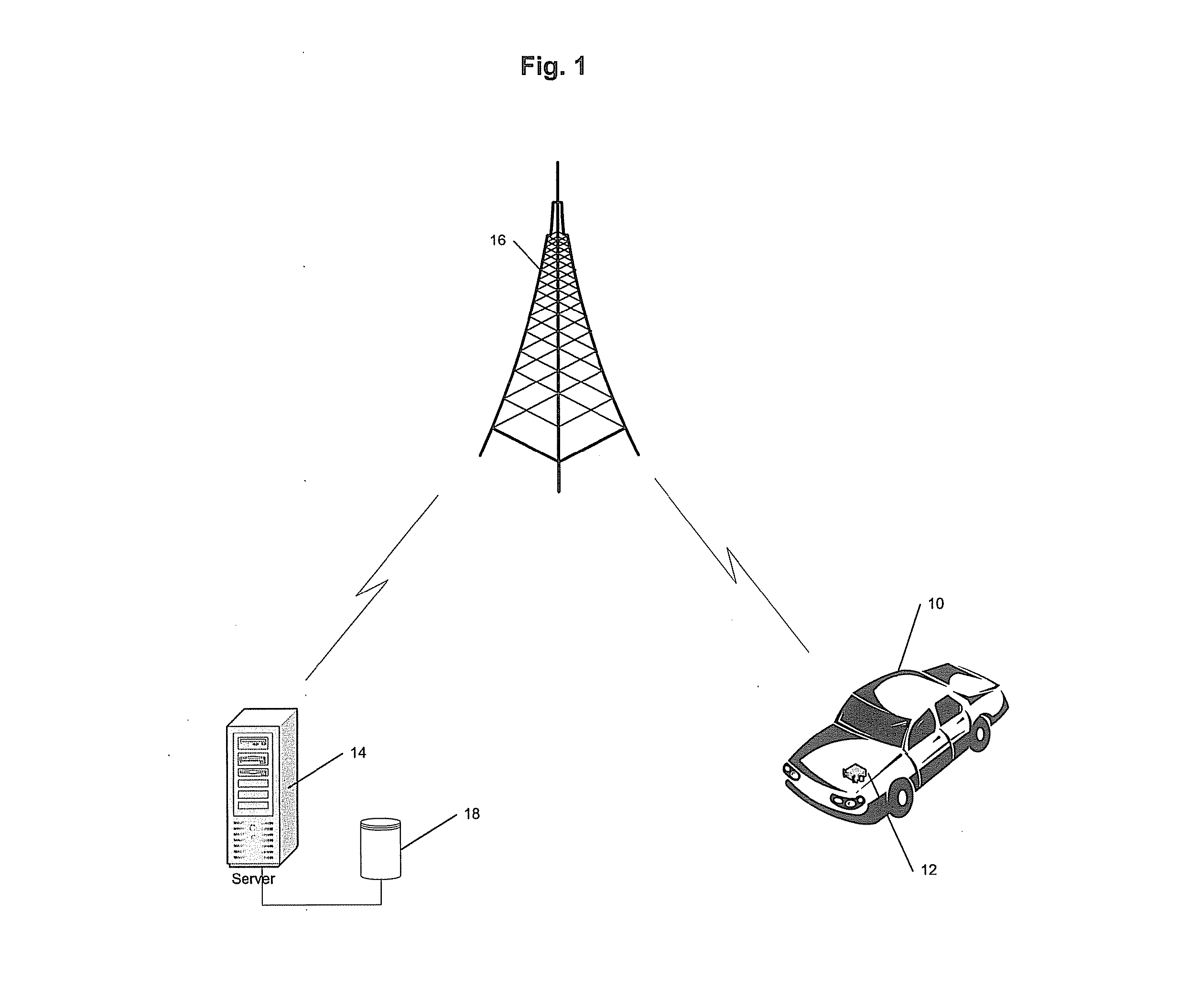

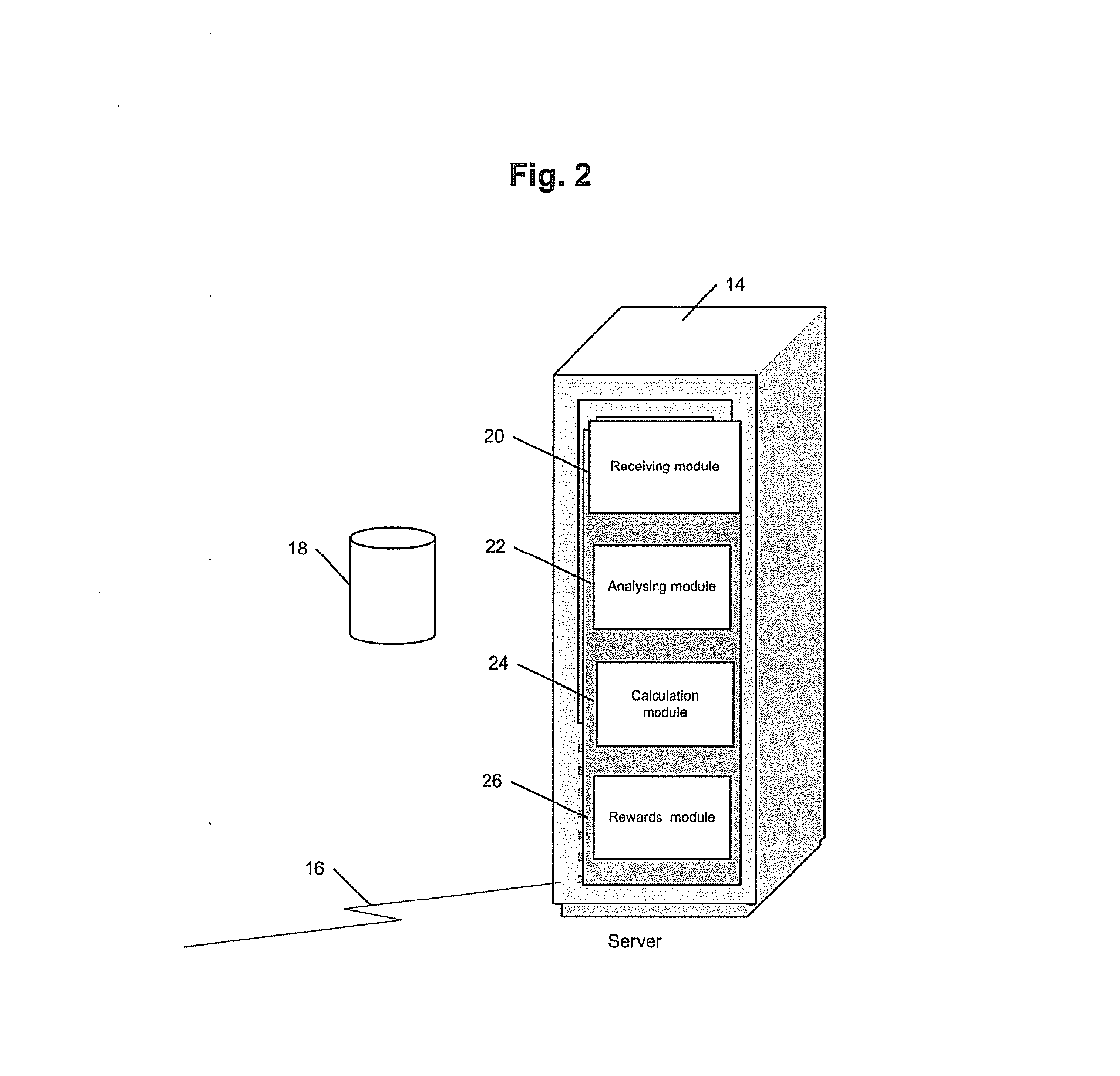

Method of managing an insurance scheme and a system therefor

InactiveUS20130085787A1Reduce the amount requiredDiscounts/incentivesFinanceProgram planningInsurance life

A method and system for managing an insurance scheme includes receiving and storing data relating to a life insurance agreement between an insured person and a life insurer including data relating to at least one premium to be paid to the life insurer and details of the life insurers obligations to the insured person or their beneficiary on the occurrence of the insured person dying or suffering disability. Receiving data including information relating to the compliance of the insured person in a plurality of programme areas related to motor vehicle driver behaviours and storing the data in a database. Points are awarded to the insured person wherein the points awarded are related to the compliance of the insured person in the programme areas and the points awarded are then used to determine a reward for the insured person from the life insurer.

Owner:DISCOVERY HLDG LTD

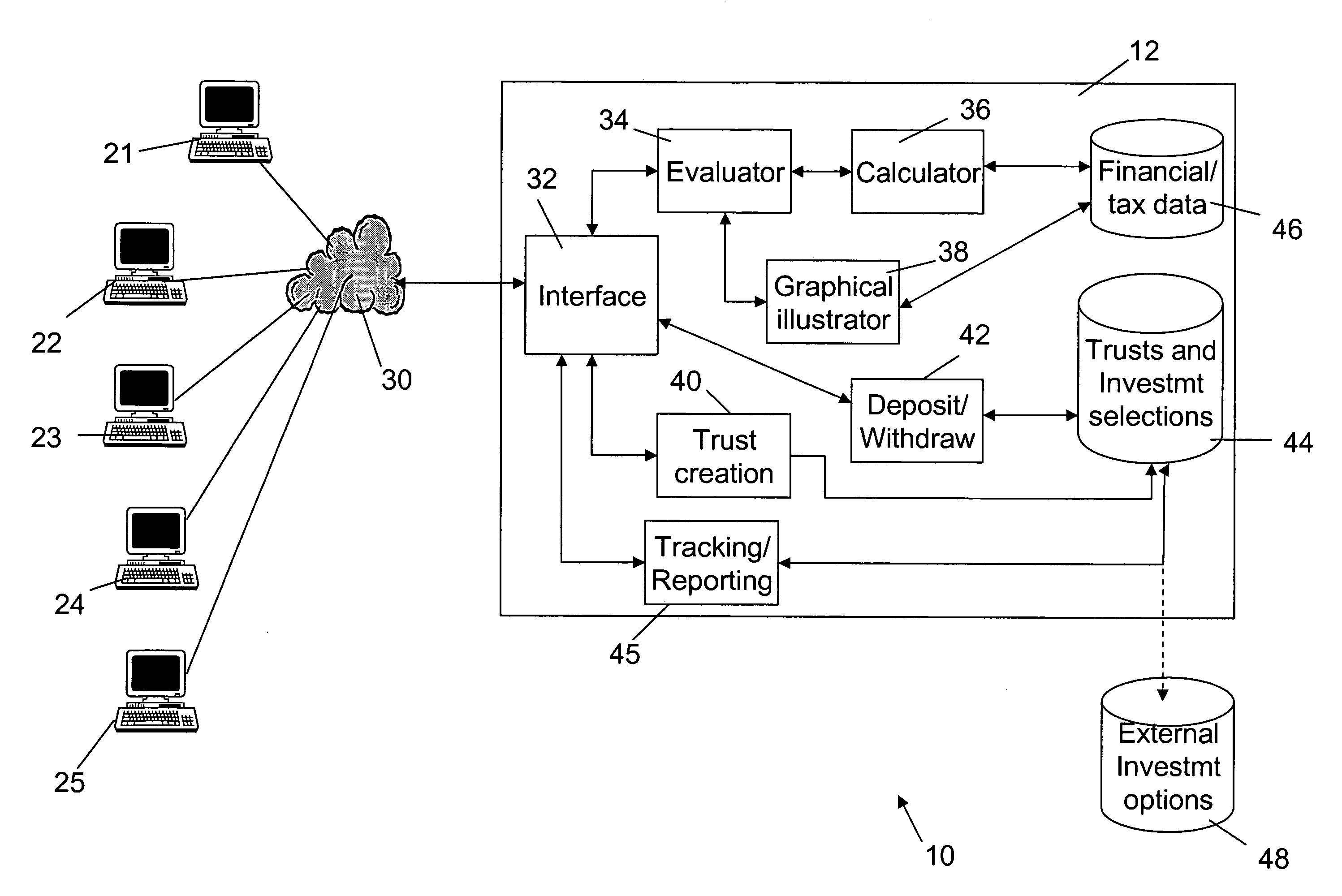

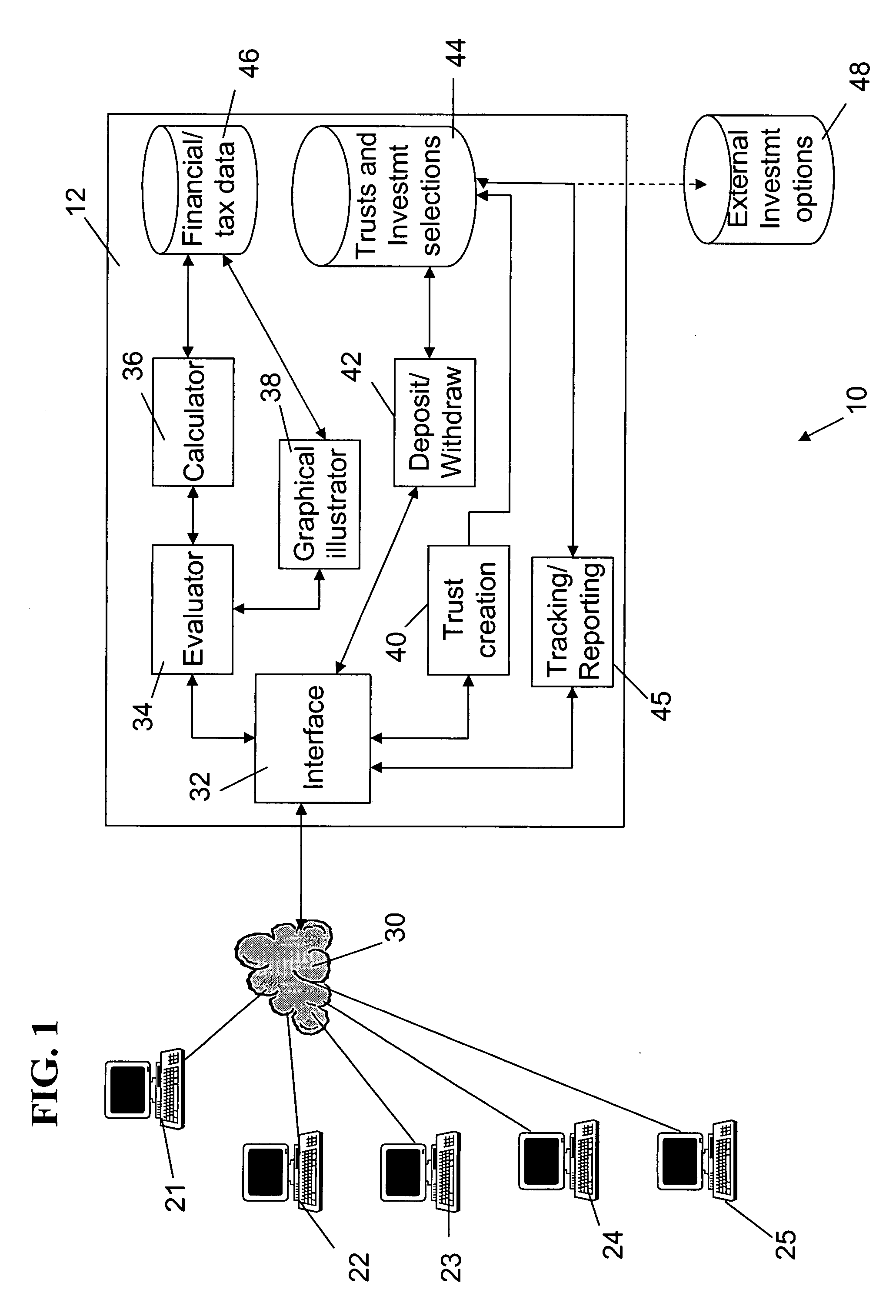

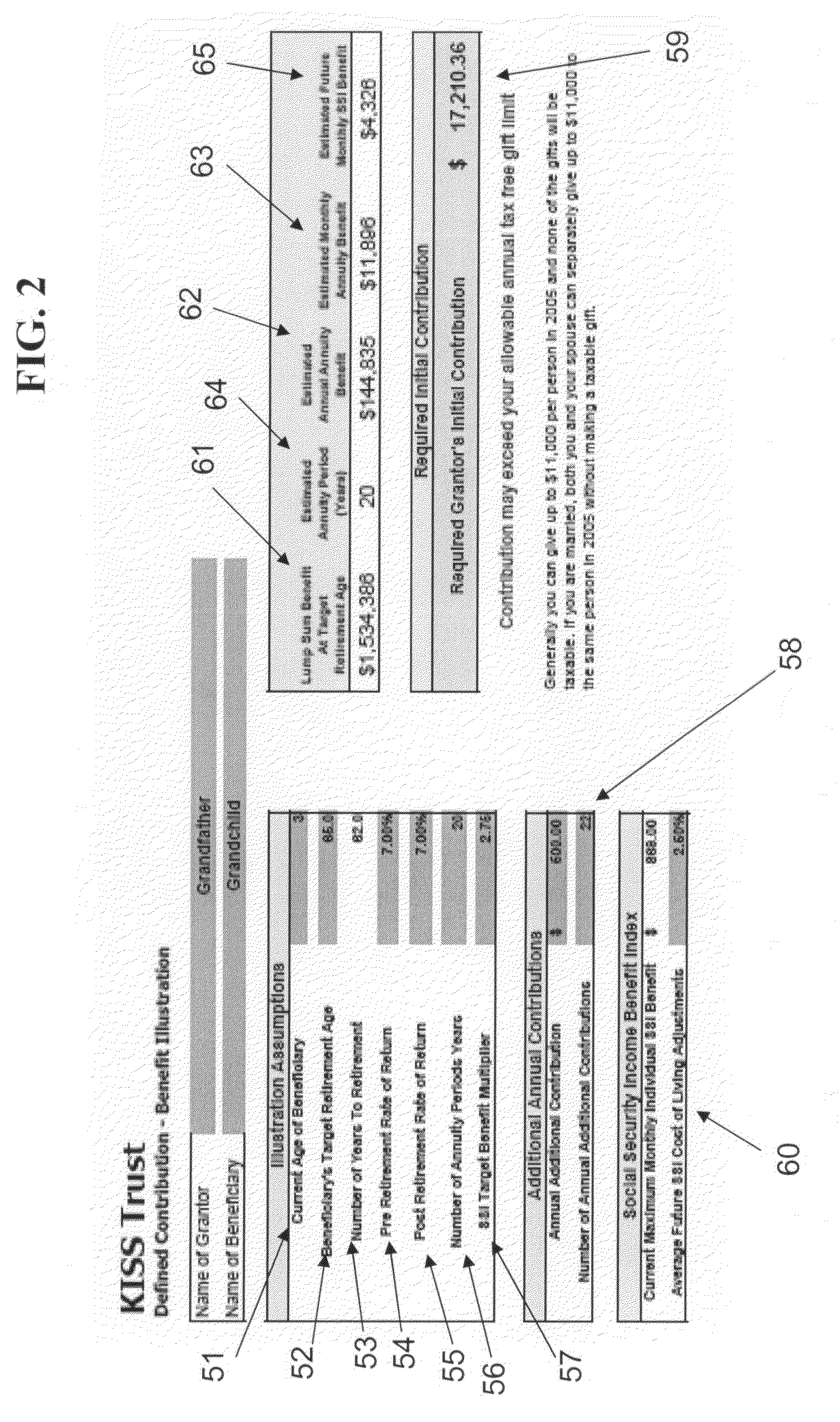

System and method for facilitating the funding and administration of a long term investment or retirement trust

InactiveUS20070271201A1Facilitating fundingFacilitating administrationFinanceInsurance lifeComputer science

The funding and administration of a long term investment and / or retirement trust for a minor child or minor children are facilitated by the present invention. In one embodiment, the present invention provides a system and method for the real-time, interactive, dynamic modeling and goal-solving for the pre-funding of a retirement benefit account specific to a minor child. In another embodiment, the present invention provides a system and method for the input of user variables specific to the requirements necessary for the real-time production of trust documents necessary and specific to the purpose of establishing a funded pre-retirement trust for a minor child. The present invention accommodates age-banded funds and investment options, life insurance funding vehicles, loan funding vehicles and alternative (e.g., non-retirement) distribution options.

Owner:NAT TRUST & FIDUCIARY SERVICES

Mortgage management system and method

A system and method for minimizing mortgage payments and operable in conjunction with an insurance policy. The system comprises a first module that contains information regarding terms of a mortgage. The terms include a principal amount of a mortgage, and an interest rate for the mortgage. Further, a second module contains information regarding terms of an insurance policy that is in existence during the life of the mortgage. The terms of the insurance policy preferably include the total amount of proceeds of the insurance policy, the premium amount to be paid for the insurance policy, and the beneficiary of the life insurance policy. Further the invention includes a tracking system that tracks interest payments made on the interest of the mortgage and further tracks premium payments made on the premium amount on the insurance policy. The proceeds from the insurance policy are reserved to pay the principal on the mortgage.

Owner:IZYAYEV ROMAN

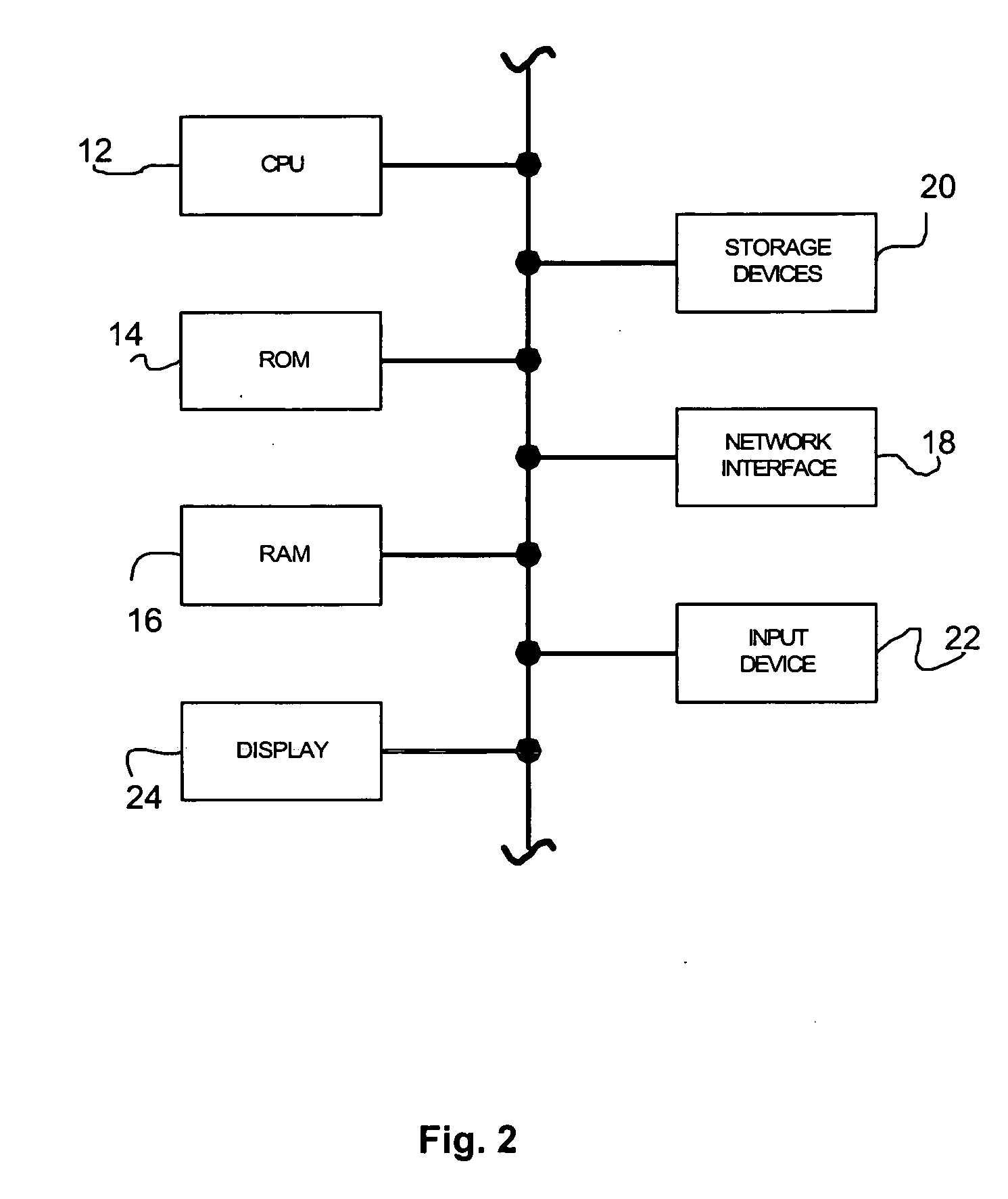

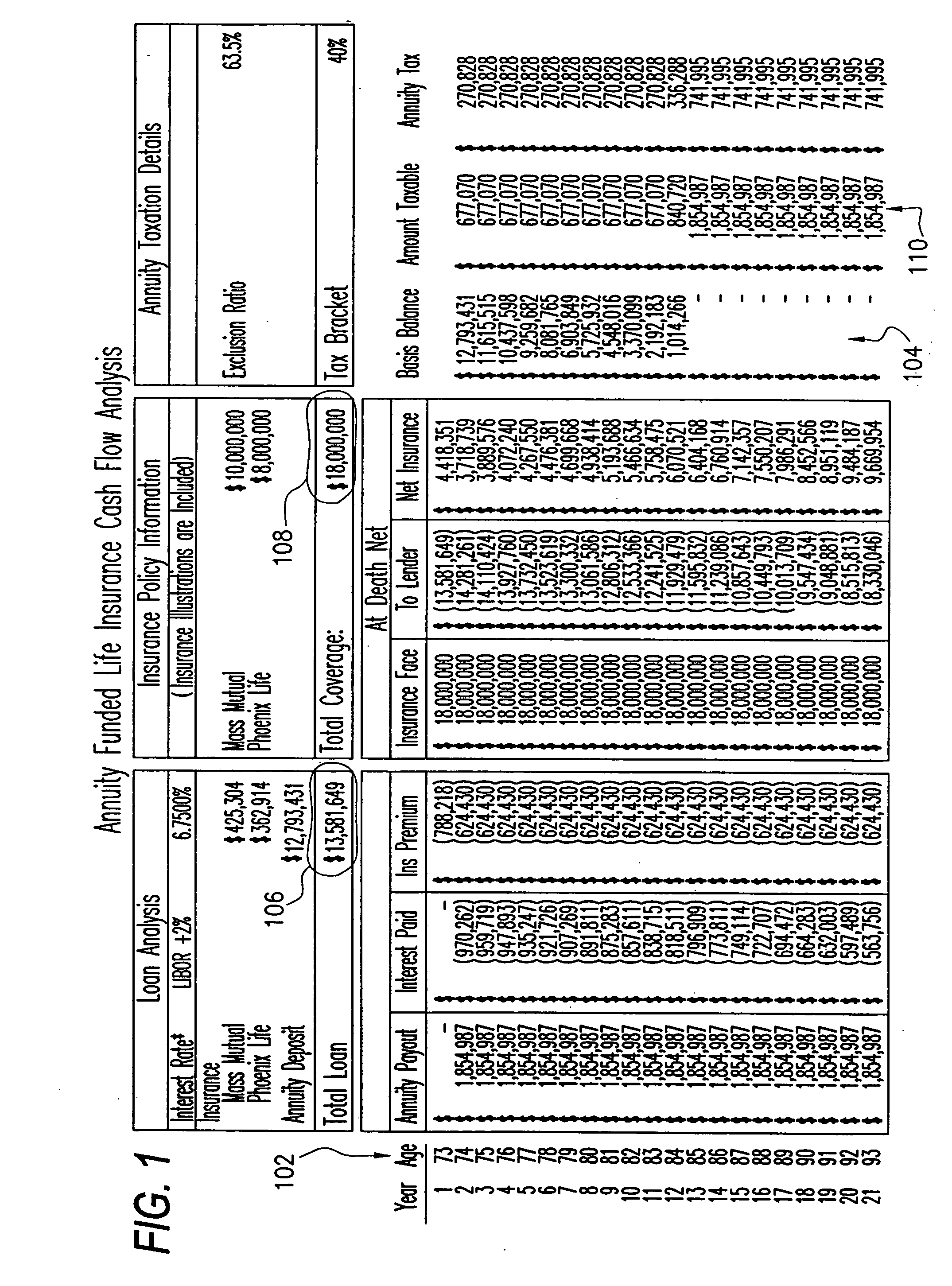

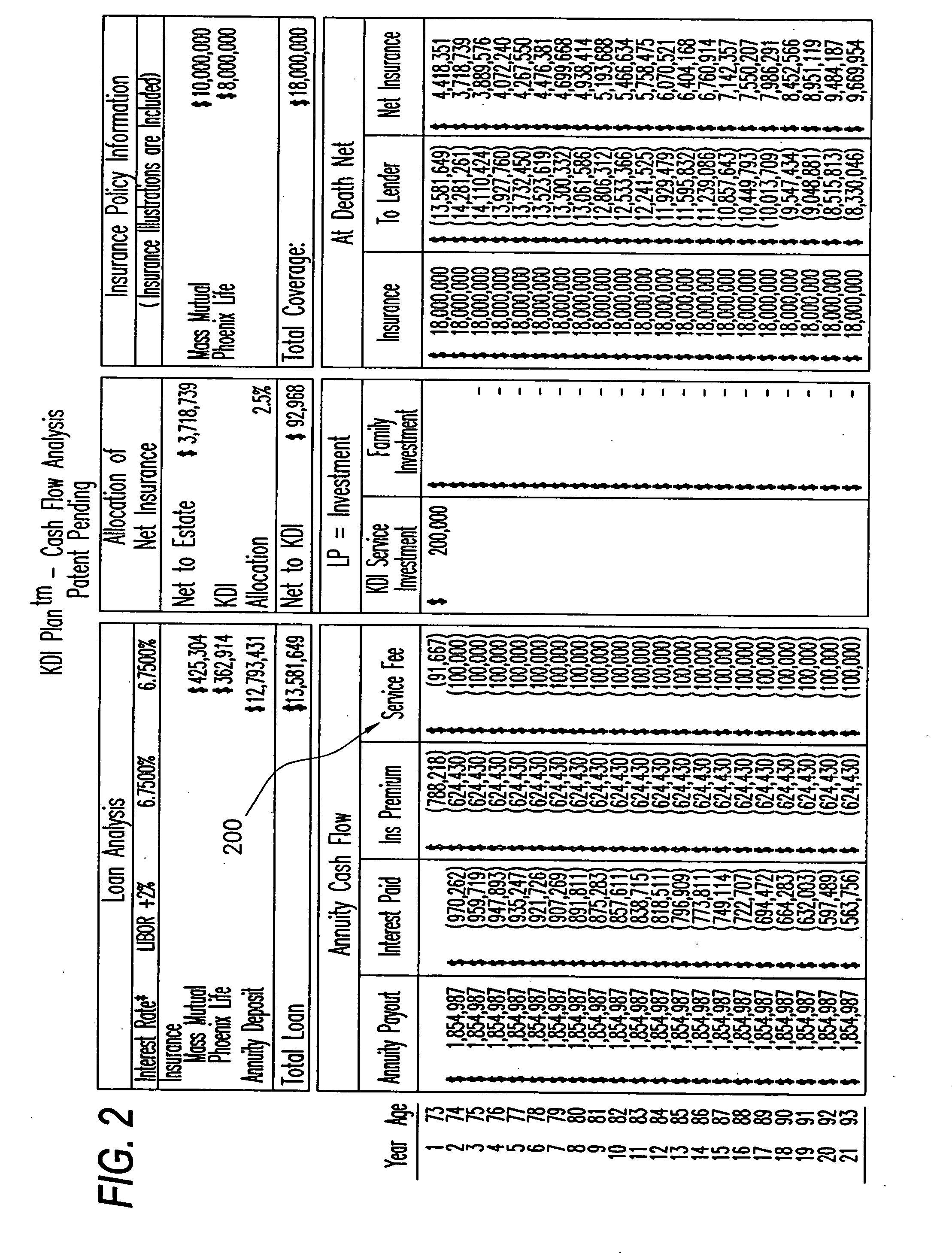

System for funding, analyzing and managing life insurance policies funded with annuities

The invention relates to a program that administers a method of funding life insurance policies using annuities that are purchased at least in part using borrowed money, using business and trust structures to reduce and / or eliminate tax. This investing can be done either directly by the policy or through the trust and / or other business entity. As an internal investment of the insurance policy the income generated by the annuity and the inside build-up are non-income taxable to the owner of the policy. The resulting death benefits will also be non-income taxable to the beneficiary.

Owner:KAVANAUGH BART

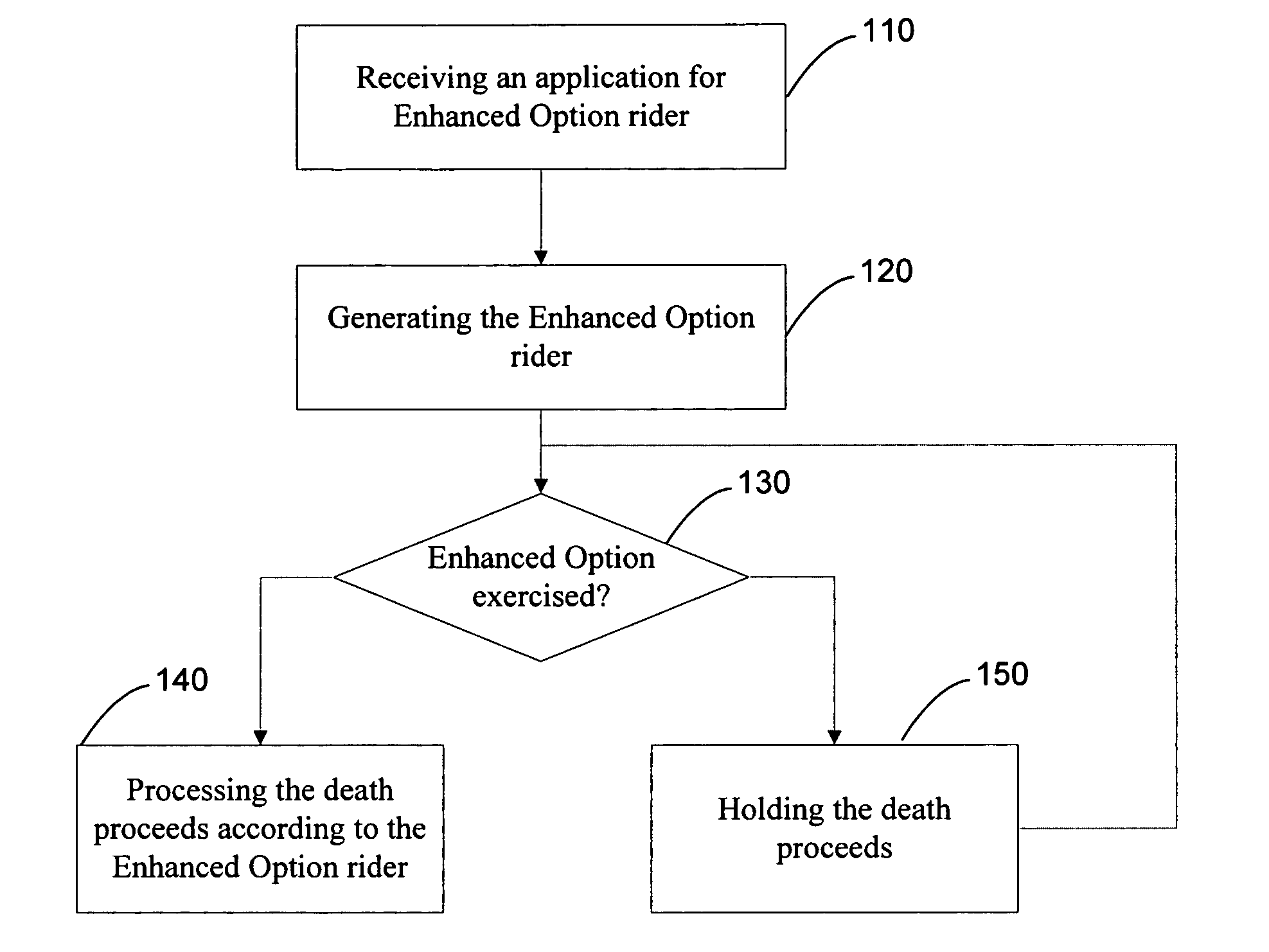

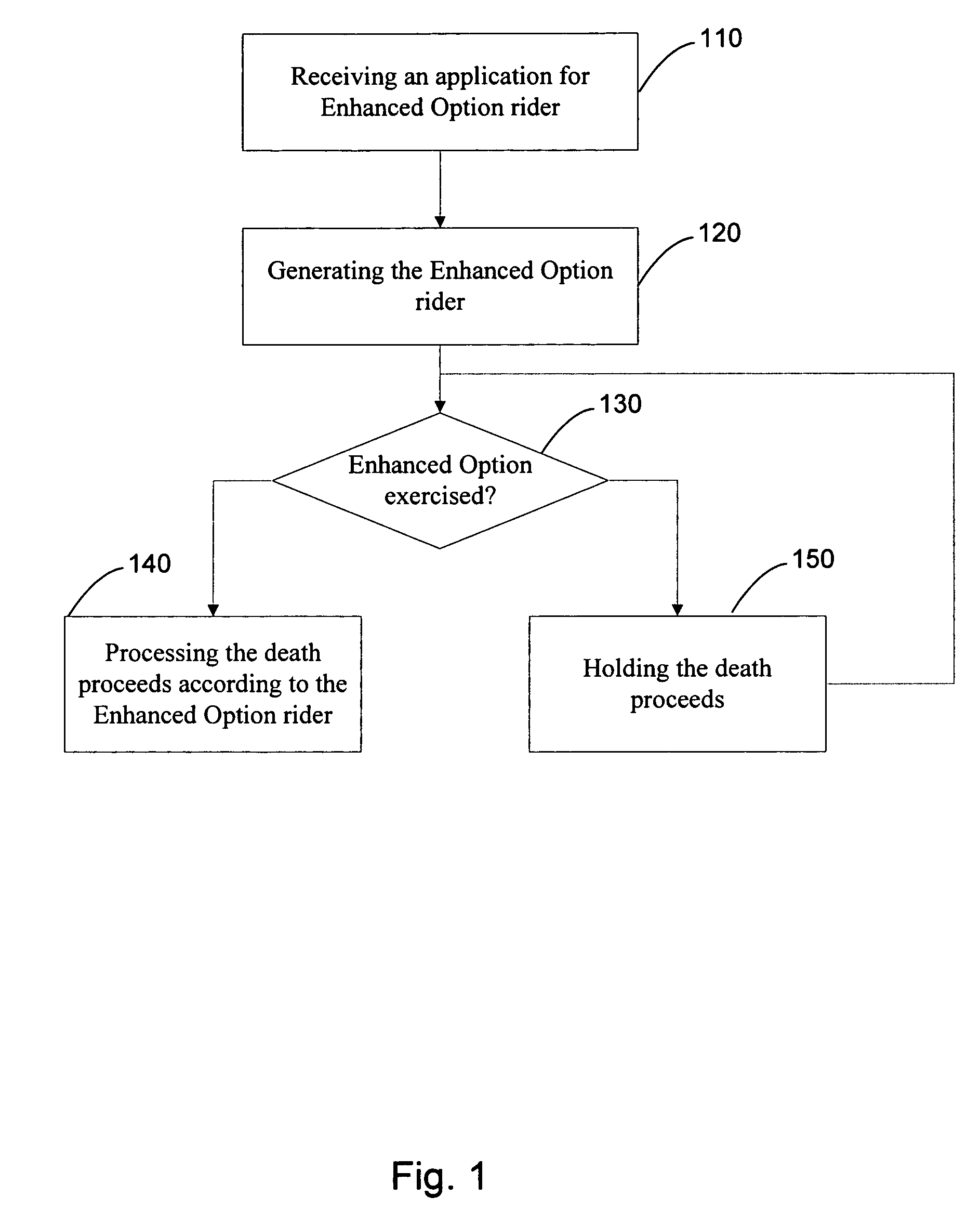

Systems and methods for providing an enhanced option rider to an insurance policy

In one aspect, the invention comprises a computer system for providing a life insurance policy with an enhanced option rider, comprising: an electronic database operable to store data related to policyholders and policy terms; and an insurance administration computer, in communication with the database, for administering the policy; wherein the enhanced option rider allows each beneficiary of the life insurance policy to apply all or part of eligible proceeds to one or more enhanced payment options, and wherein the one or more enhanced payment options comprise a guaranteed monthly payment through an annuitization process for the life of the one or more beneficiaries.

Owner:METLIFE

System for managing the total risk exposure for a portfolio of loans

A computer system for monitoring and enhancing the collateral security underlying a set of loans is provided, including a system for calculating the unsecured value of the set at any time and for initiating additional collateral enhancement instruments when the unsecured value exceeds a certain limit. The system may include a variety of modules in communication with a relational database for storing data about the loans and system elements. The computer system may also be configured to allocate, manage, and execute the waterfall or cascade of funds between and among the various participants in a financial plan. The invention also includes a structured finance plan and related methods for enhancing the collateral security of a loan obtained for a life insurance or annuity product, and a system and method for managing a portfolio of such loans in order to obtain favorable financing and to facilitate securitization.

Owner:ENTAIRE GLOBAL INTPROP

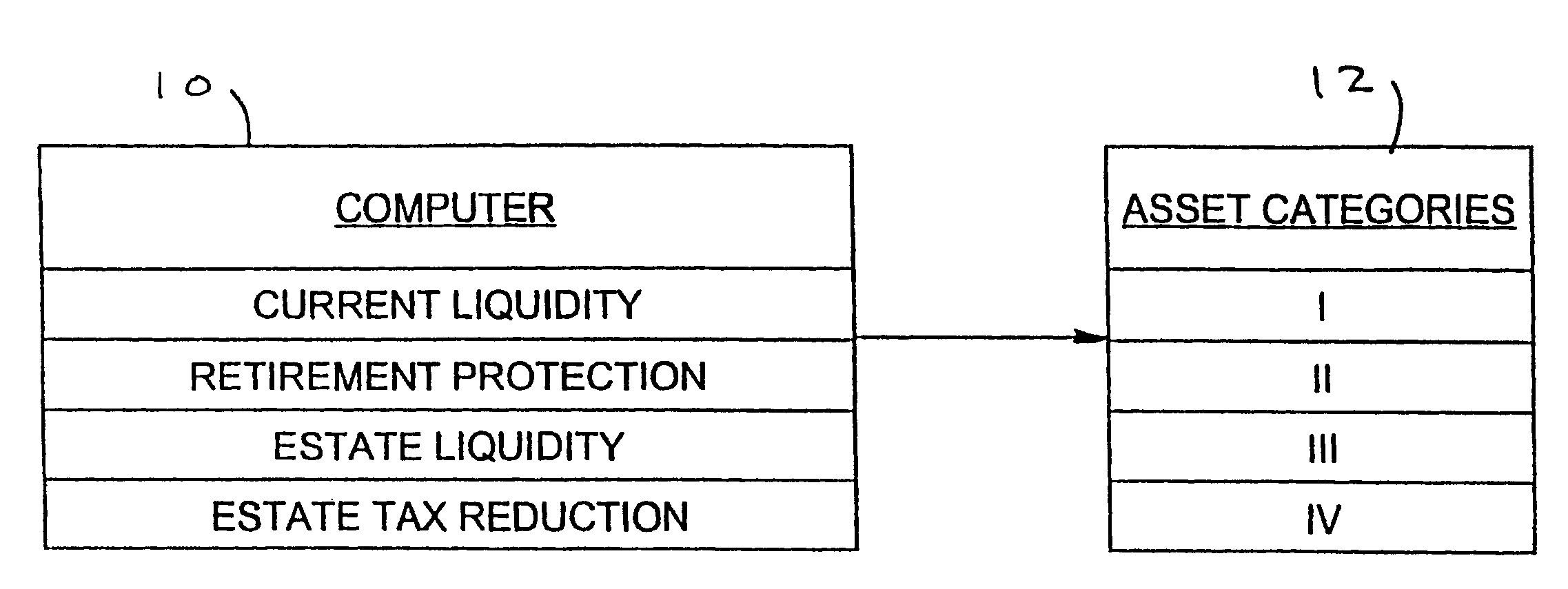

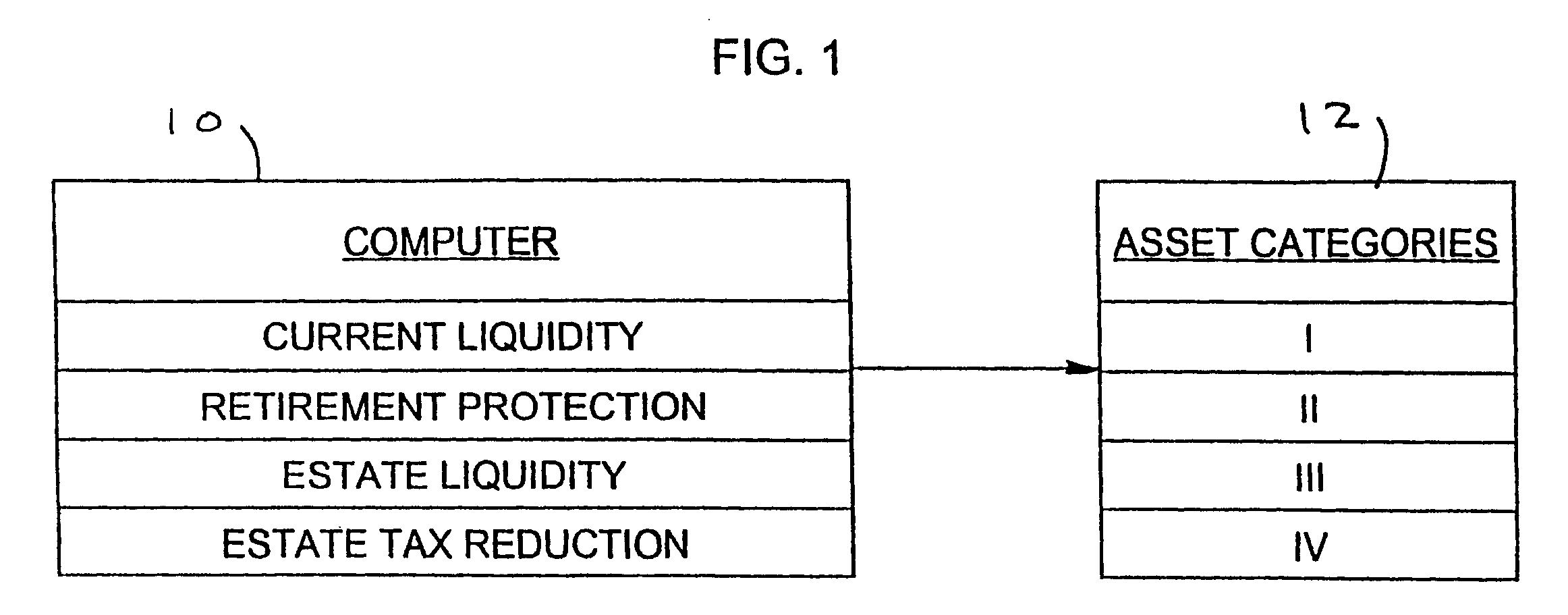

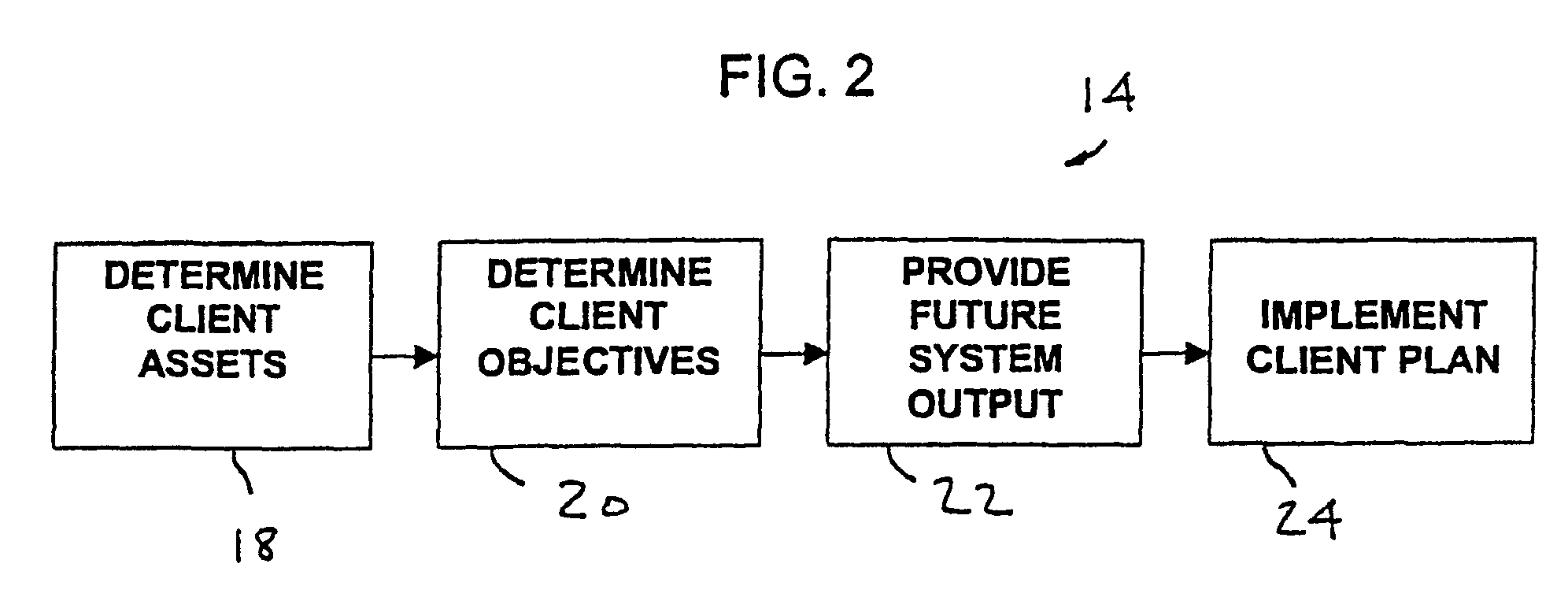

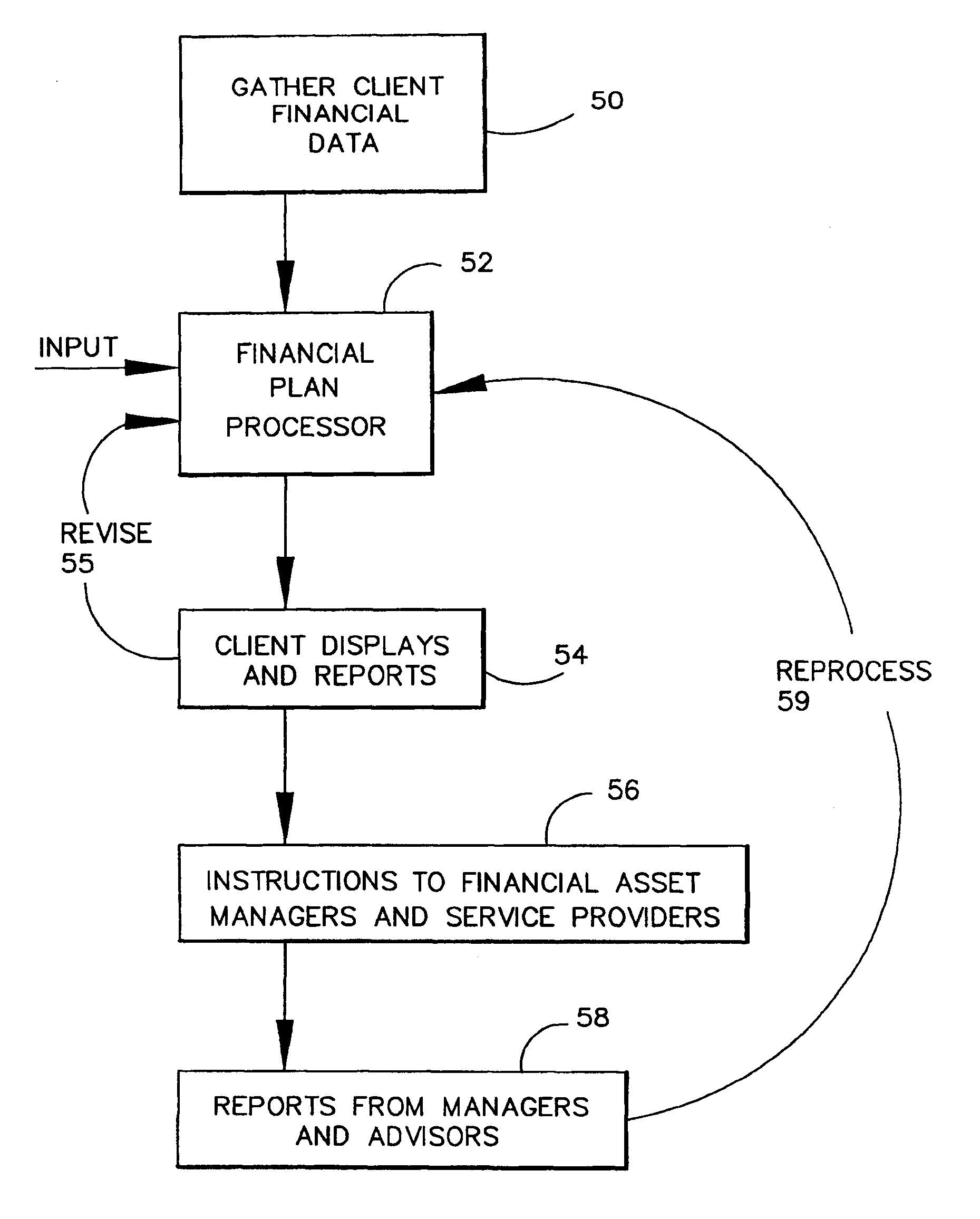

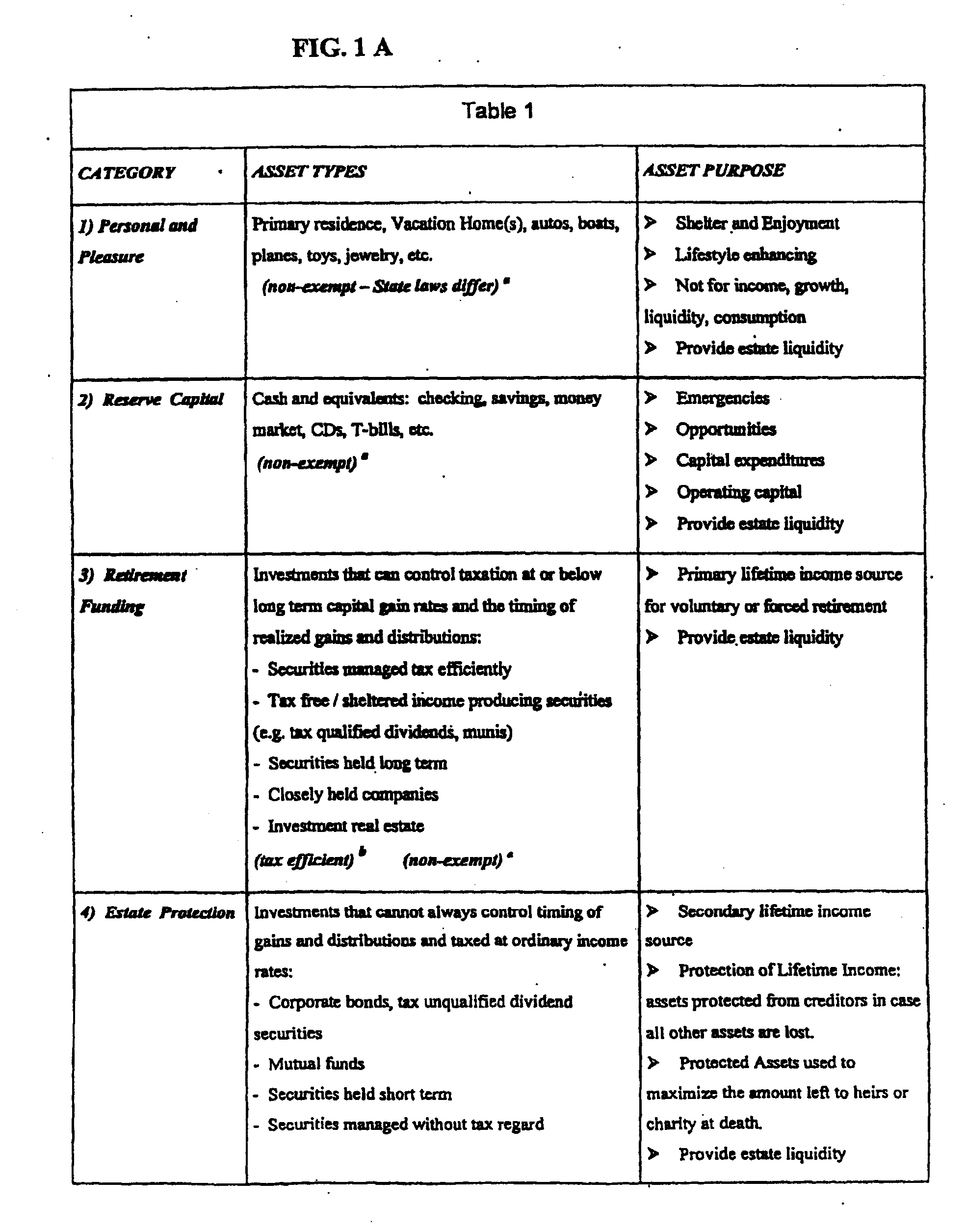

Process for comprehensive financial and estate planning

A process for generating a financial and liquidity estate plan for a client and defining a life insurance product for use therewith. The process includes determining the client's assets and defining a plurality of asset categories based on type and purpose of asset. The process also includes categorizing the client's assets in the defined categories. By performing liquidity analyses of the categorized assets, the process determines current estate liquidity and projected future estate liquidity of the client. The process further includes generating a plan for re-allocating the client's assets among the defined categories based on the liquidity analyses. The product defined by the process is a pre-paid, variable life insurance product having a death benefit that varies daily as a function of gains and losses on the invested cash 10 value of the product.

Owner:FUTURE SYST ADVISORS

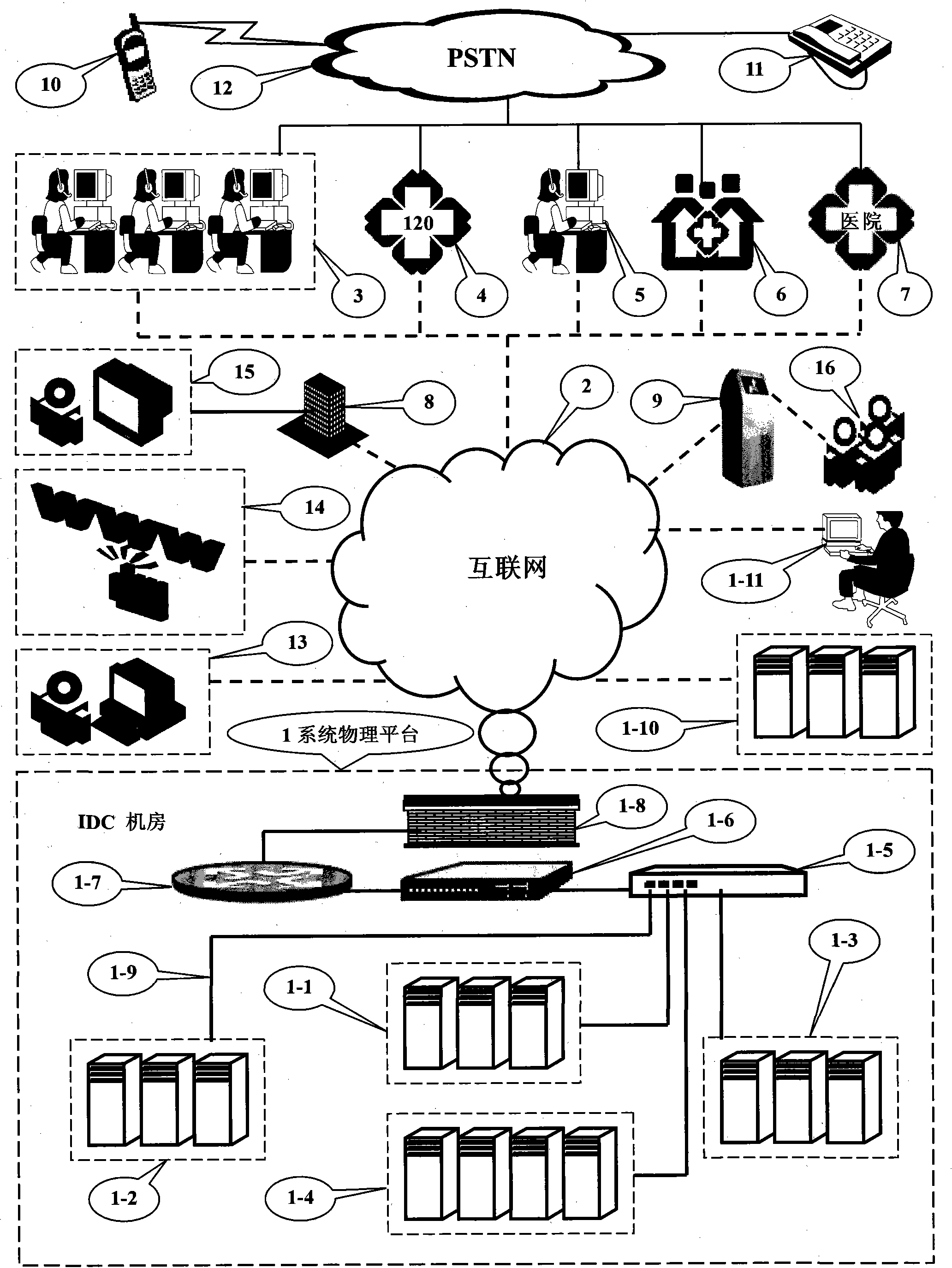

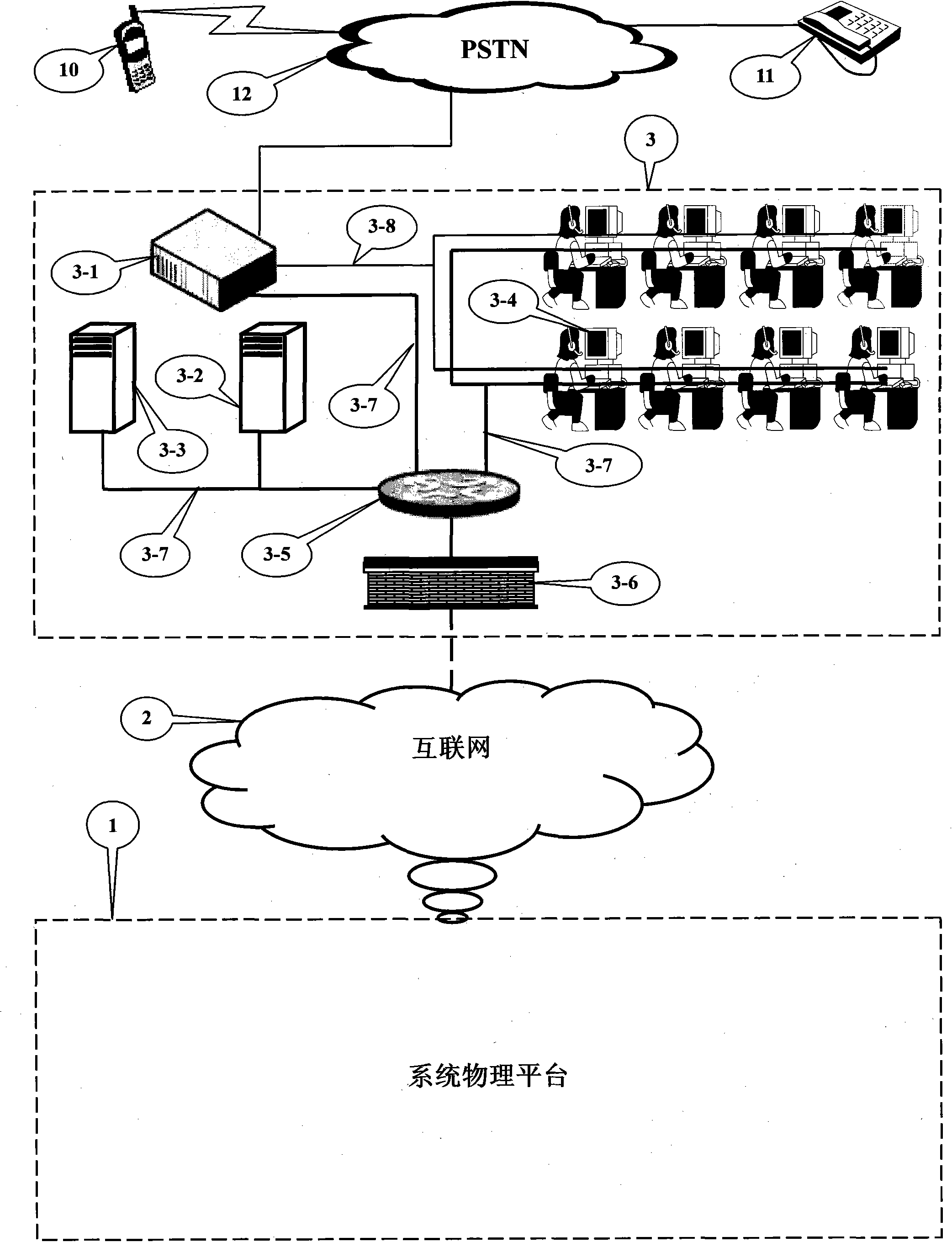

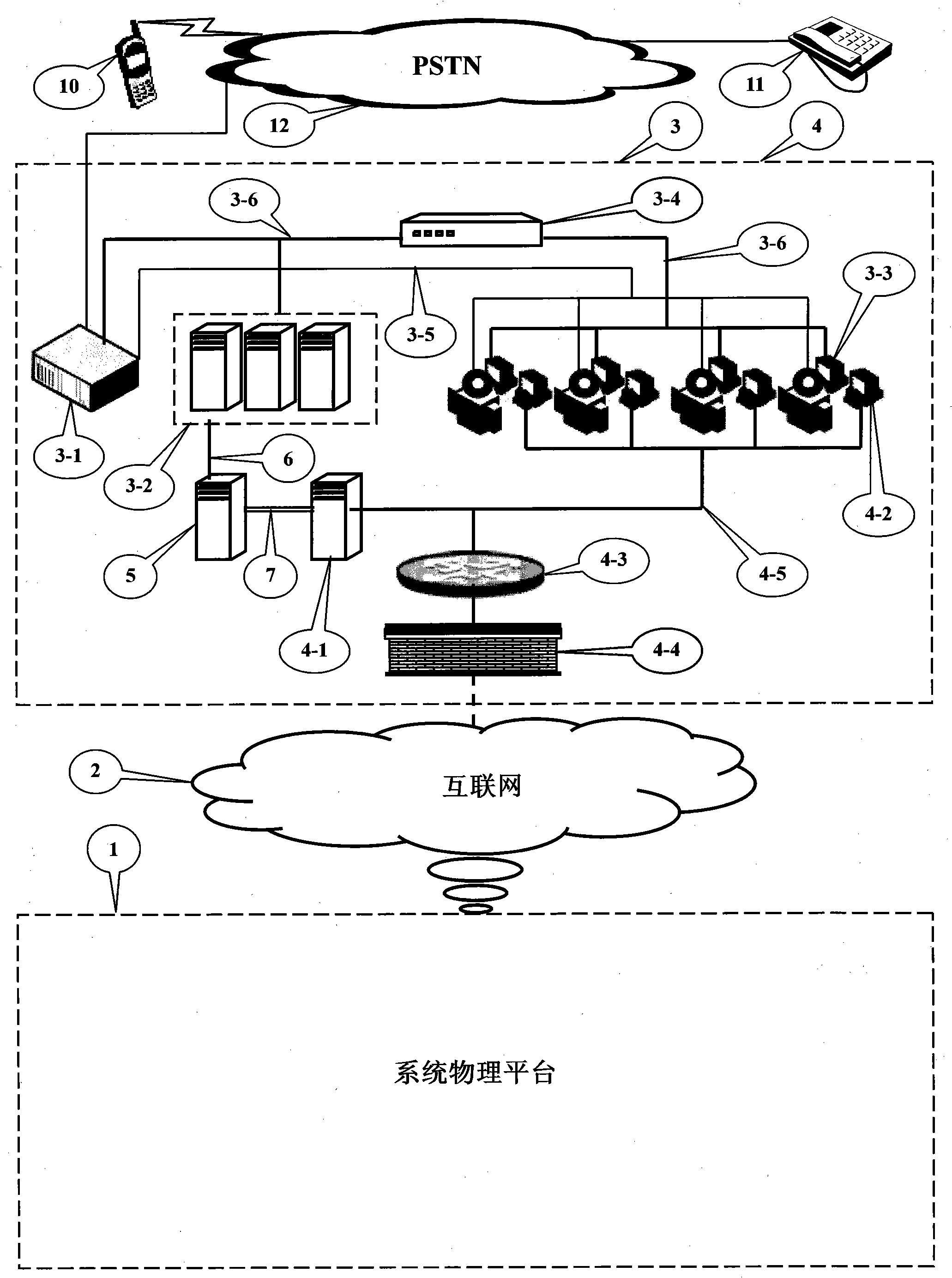

Method for constructing full-coverage all-direction resource sharing family endowment service system

InactiveCN101795333AFix bugsSolve problemsTelephonic communicationTransmissionInformation processingCall termination

The invention relates to a method for constructing a full-coverage all-direction resource sharing family endowment service system, belonging to the field of the information processing and transmission technology. The invention is technically characterized by mainly comprising a system platform, an Internet website subsystem, a call platform subsystem, an Internet aged-people interaction subsystem, a 120 first-aid supplementary information service subsystem, a home delivery logistics subsystem, home service scheduling subsystem and a call termination subsystem, wherein the call termination subsystem mainly comprises a computer, dual tone multi-frequency signal receiving and transmitting equipment, a telephone terminal and computer software. The family endowment service system constructed with the method can be used as an integrated network service system in the community and further as a digital information platform. The method of the invention is not only a special method applied to a special object but also a general method for constructing an information processing and transmission system serving the public. For example, the method of the invention can be used for constructing the full-coverage all-direction resource sharing life insurance service system.

Owner:贾华

Financial Planning System

The financial planning tool is software defining a data structure which generates a financial-estate plan using liquidity analysis of a comprehensive list of client assets (categories I-IV, personal, reserve capital, unprotected retirement, and protected retirement assets). The system obtains asset net equity before and after tax and calculates life annual income based on a financial formula with modifiable variables. Current estate tax values and liquidity at-death values for estate conditions (client and spousal death, spousal survival and client survival). Post-death annual income is calculated. Comparing unprotected and protected life annual income for asset categories I-III vs. IV with goals, identified surpluses and deficiencies result in transfer or liquidation-repurchase of assets between categories. Conventional life insurance is either purchased or cancelled or a daily rated, minimum at risk death premium life insurance product is purchased.

Owner:FUTURE SYST ADVISORS

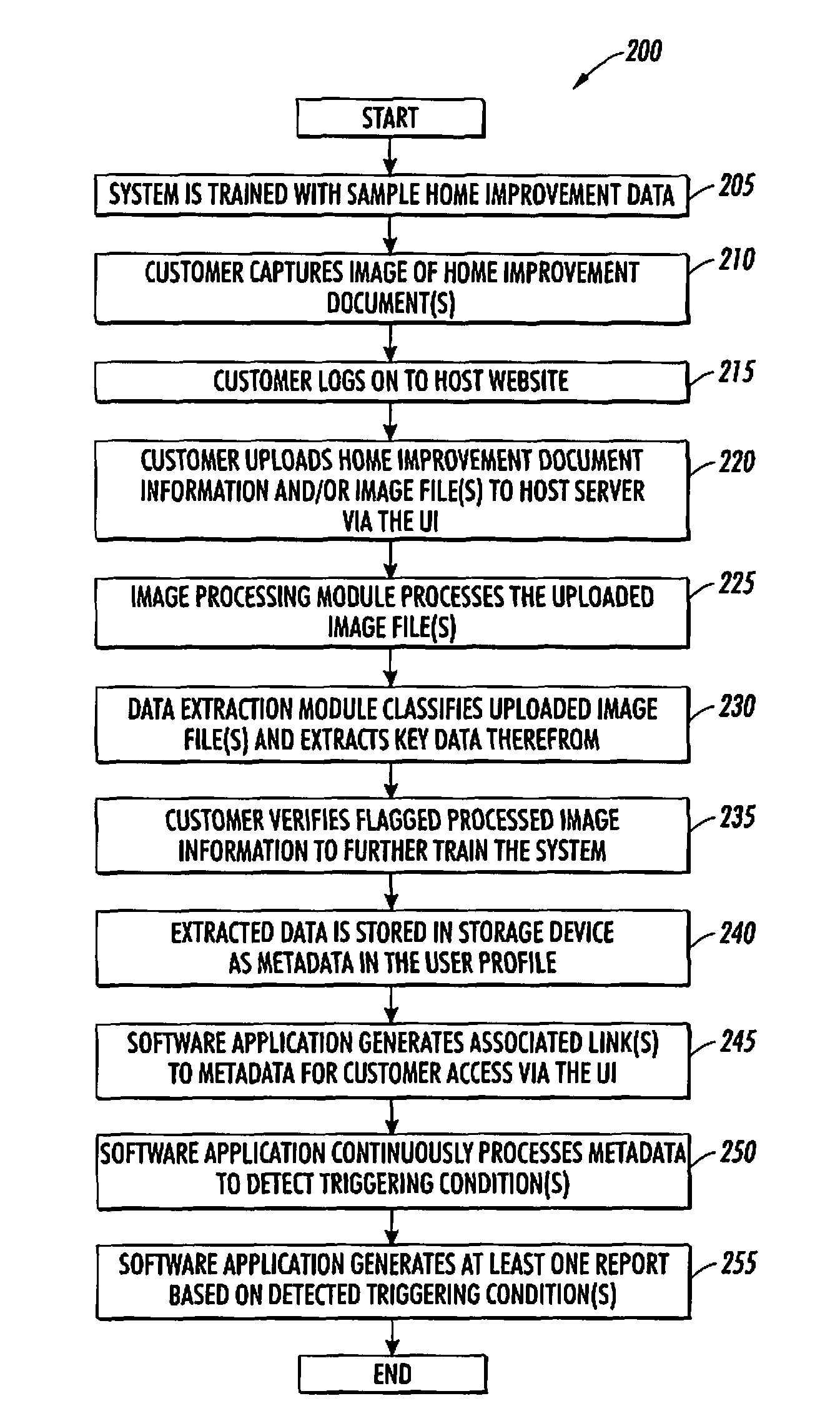

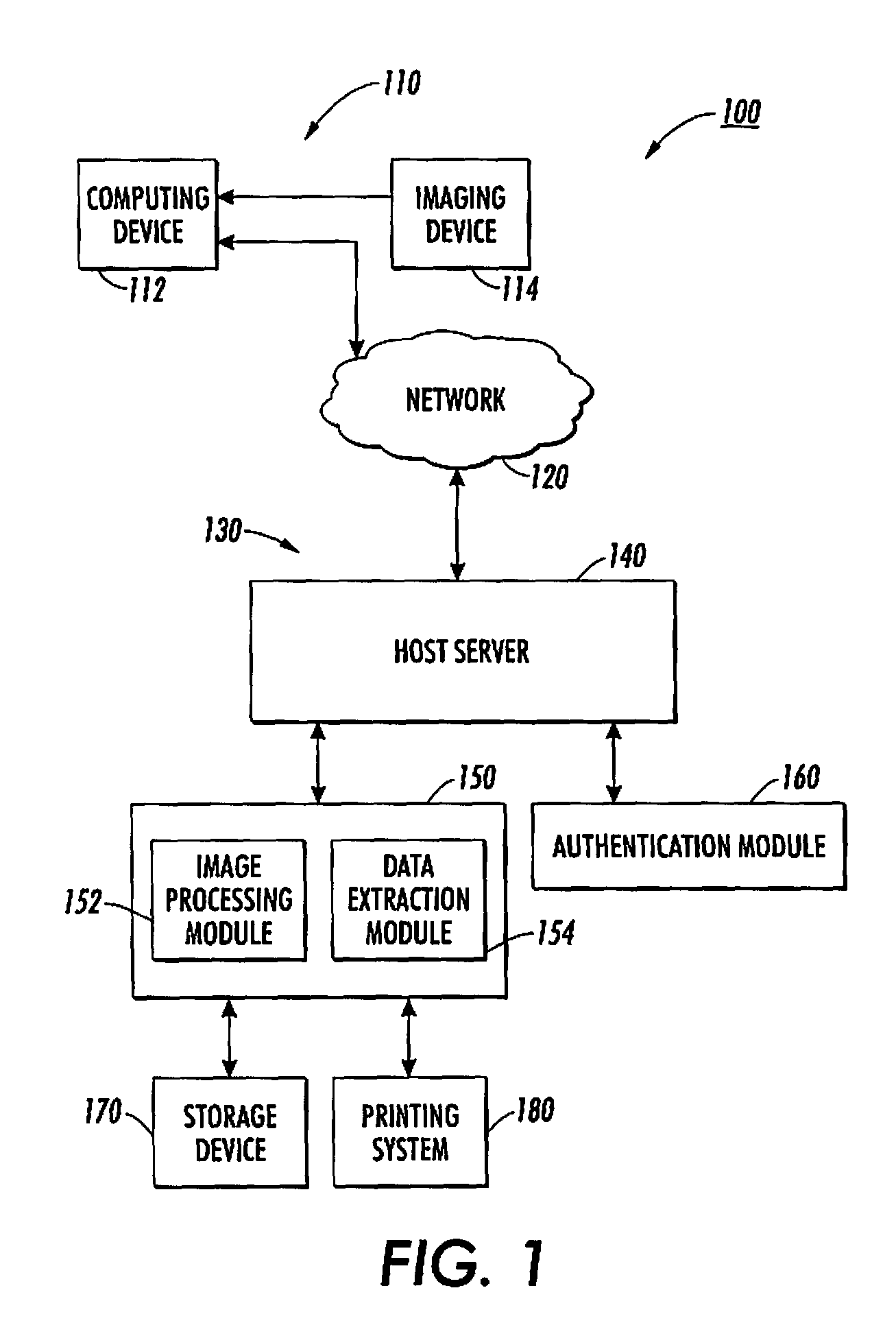

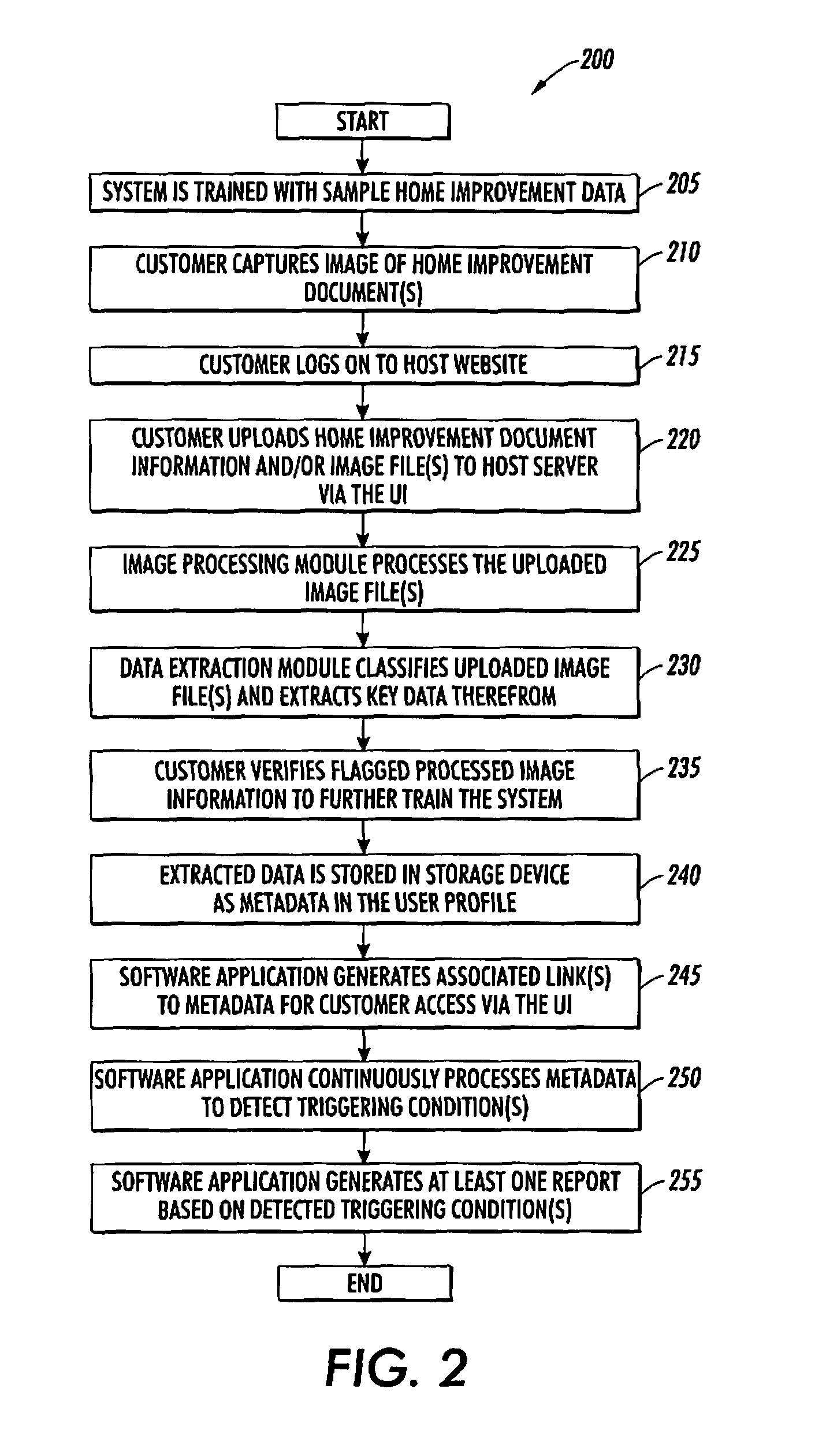

Online life insurance document management service

An online life insurance document management service includes a host server having a web-based interface adapted to facilitate secure customer access to the host server. The host server is configured to receive life insurance data communicated from the customer through use of a computing device. A processing module is in operative communication with the host server and is configured to process the life insurance data communicated from the customer. A processing software application is trained to classify the processed life insurance data and selectively extract data therefrom based on the classification. The processing software application is configured to selectively present the processed life insurance data for a customer verification via the web-based interface upon at least one of an unsuccessful classification and an unsuccessful extraction of data. A storage device is in operative communication with the processing module and is configured to store the extracted data as metadata upon at least one of the customer verification and the extraction of data. A content management software application is configured to detect at least one of a customer request and at least one triggering condition. The content management software application generates at least one report based on the detection of at least one of the customer request and the at least one triggering condition.

Owner:XEROX CORP

Method and apparatus for consumer interaction based on spend capacity

Share of Wallet (“SoW”) is a modeling approach that utilizes various data sources to provide outputs that describe a consumer's spending capability, tradeline history including balance transfers, and balance information. These outputs can be appended to data profiles of customers and prospects and can be utilized to support decisions involving prospecting, new applicant evaluation, and customer management across the lifecycle. In addition to credit card companies, SoW outputs may be useful to companies issuing, for example: private label cards, life insurance, on-line brokerages, mutual funds, car sales / leases, hospitals, and home equity lines of credit or loans. “Best customer” models can correlate SoW outputs with various customer groups. A SoW score focusing on a consumer's spending capacity can be used in the same manner as a credit bureau score.

Owner:MEGDAL MYLES G +2

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com