Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

284 results about "Credit system" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

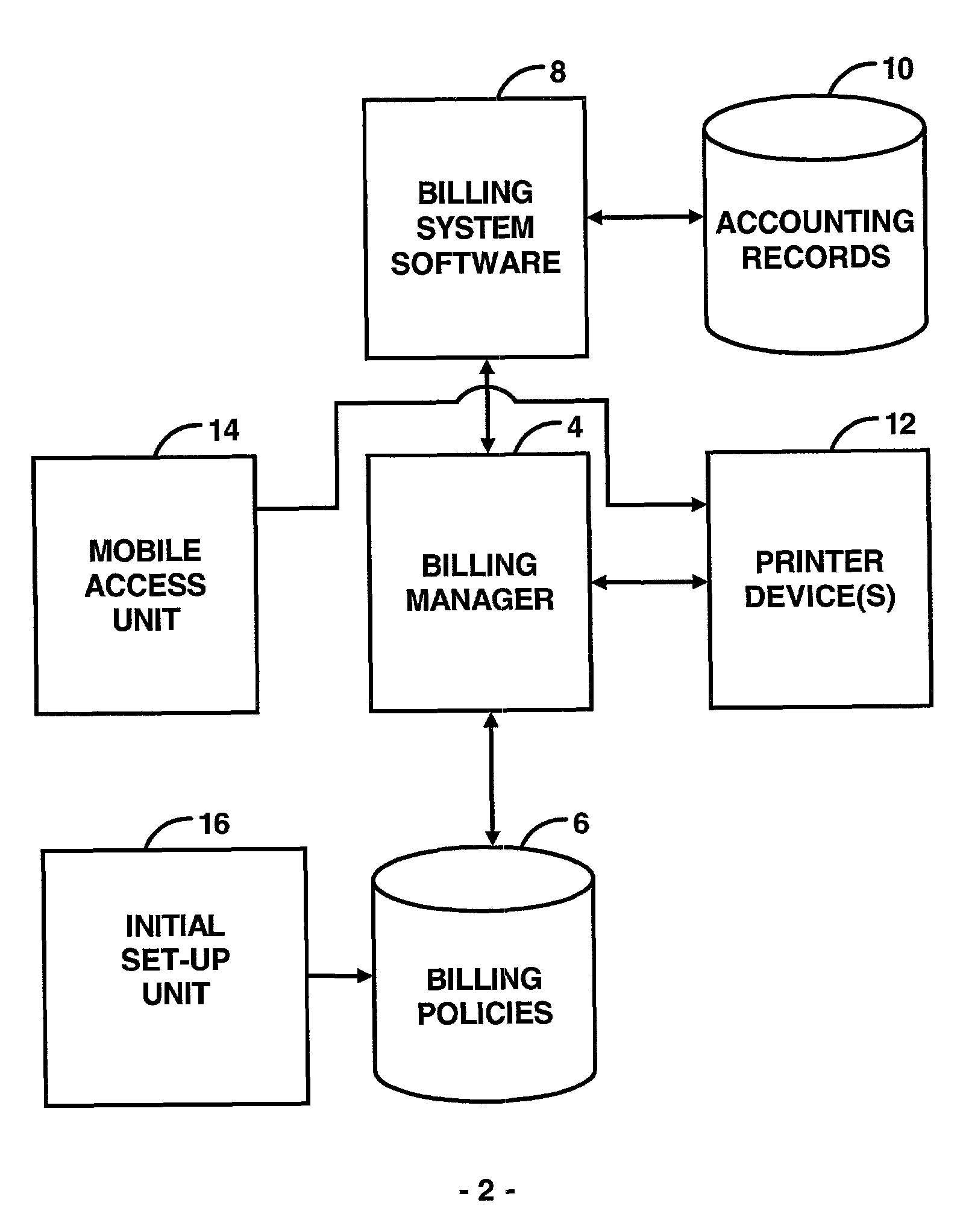

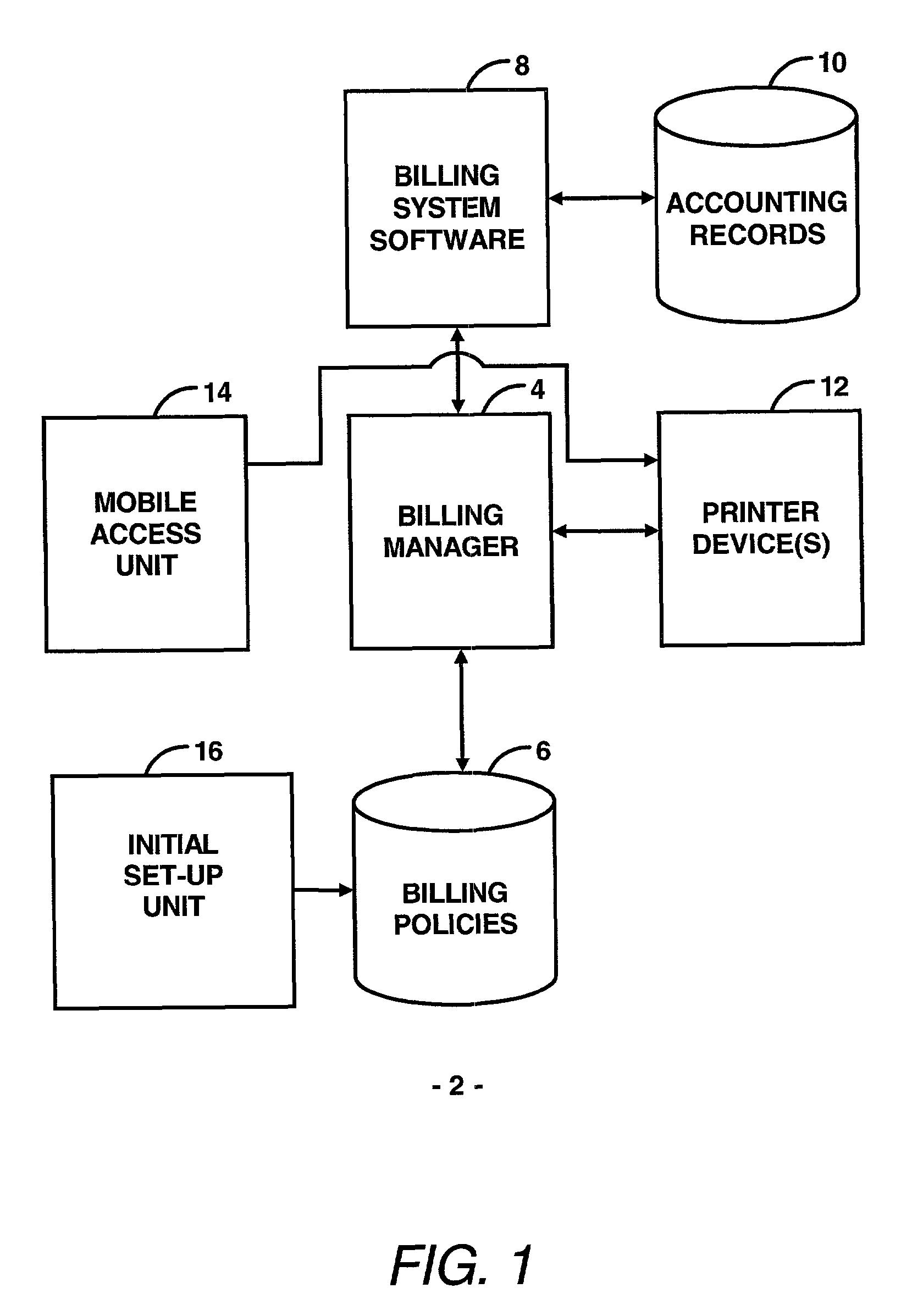

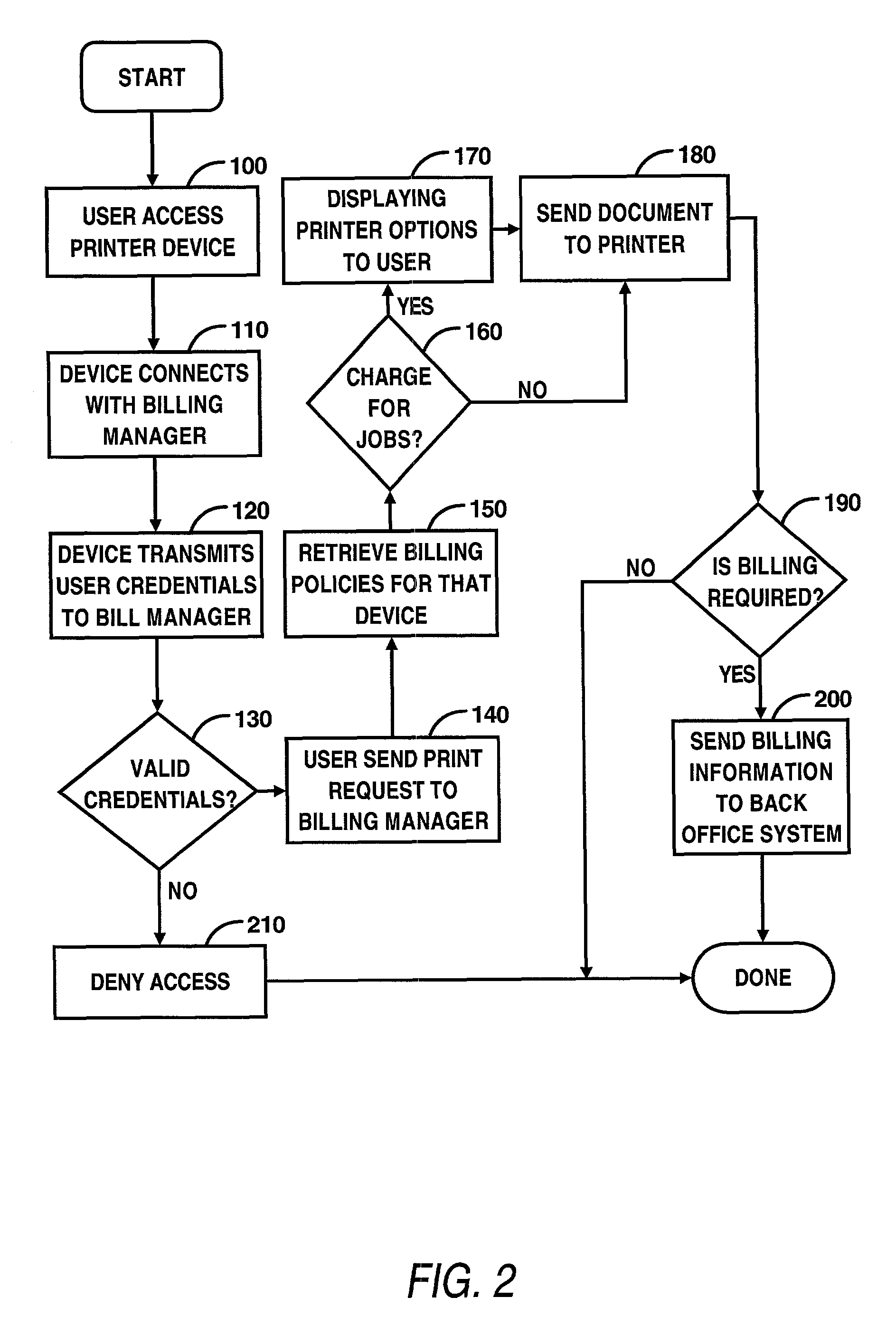

Centralized billing credit system utilizing a predetermined unit of usage

InactiveUS7882029B2Ease of configurationEase of controlFinancePayment architectureCredit systemAuthorization

Disclosed is an electronic transaction recording system for accumulating data from printer devices comprising a mobile access unit containing content which is to be printed, a printer device which receives the content from the mobile access unit and prints the content in response to a authorization process, a billing manager coupled to the printer device and the mobile access unit for determining the amount of printer usage and associating a predetermined amount of token values with the costs of printing and generates an accounting of usage based on a predetermined measure of usage and a billing system for maintaining accounting records of user and associating user account information with the predetermined measure of usage and stores account information in an account records database.

Owner:HEWLETT PACKARD DEV CO LP

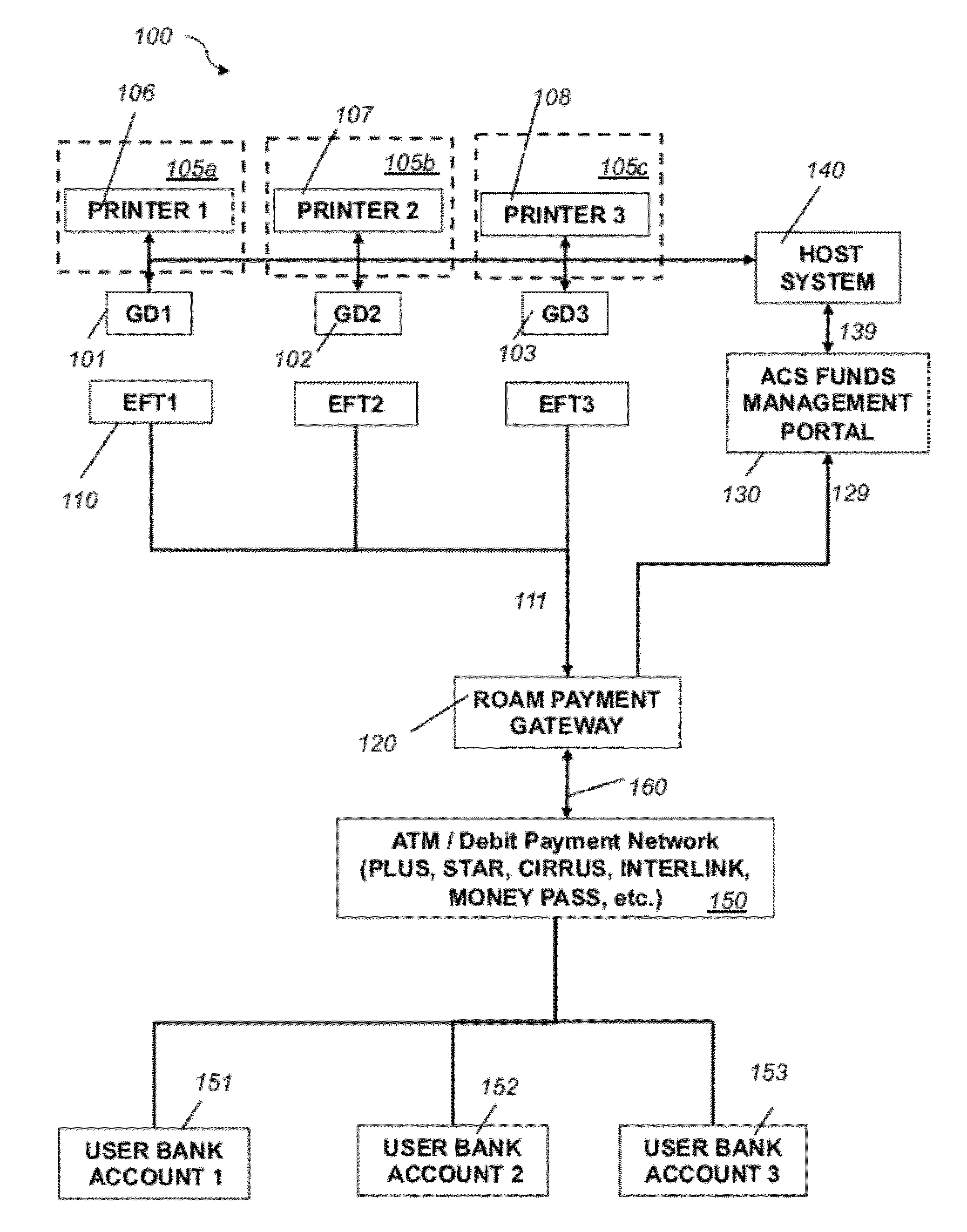

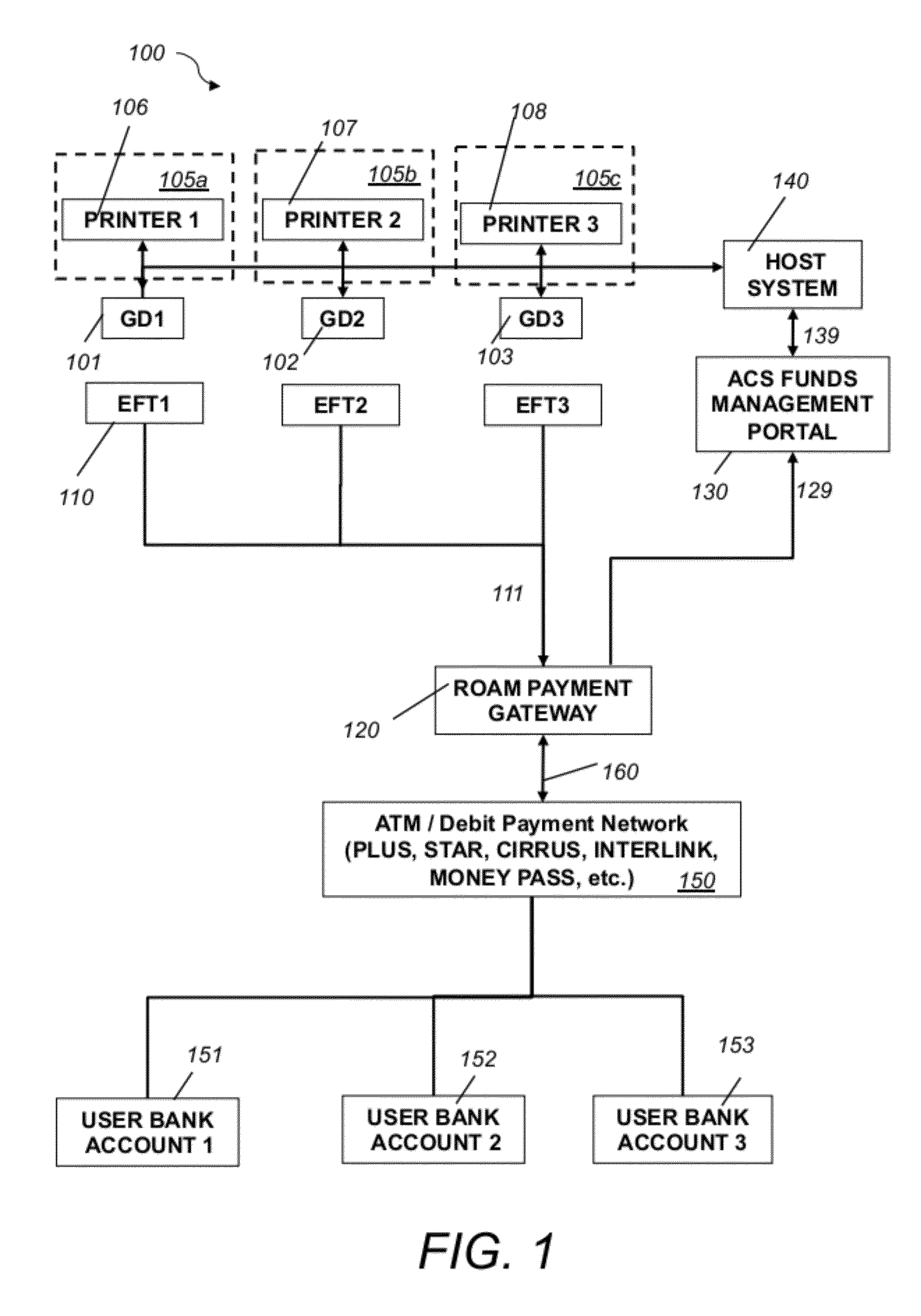

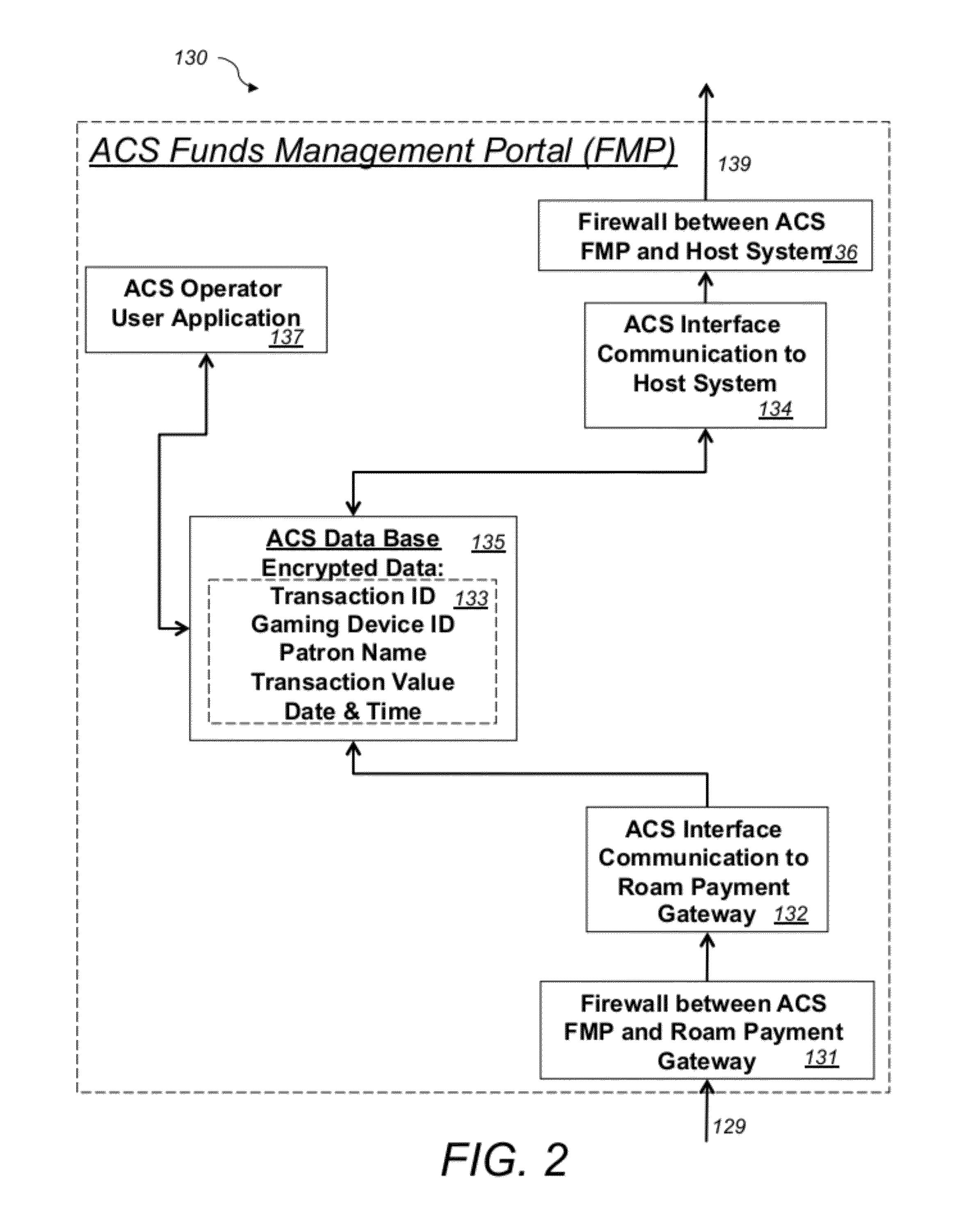

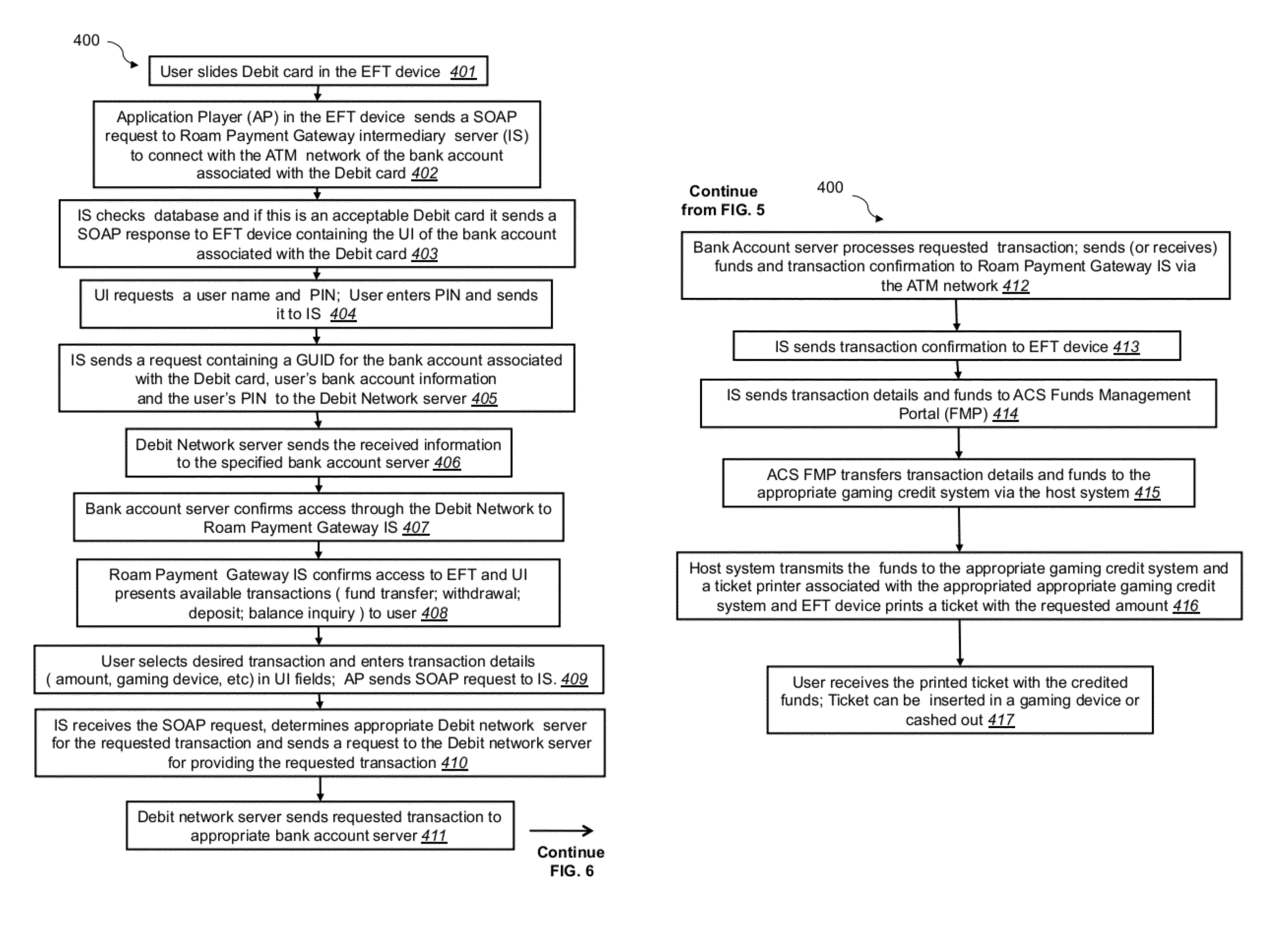

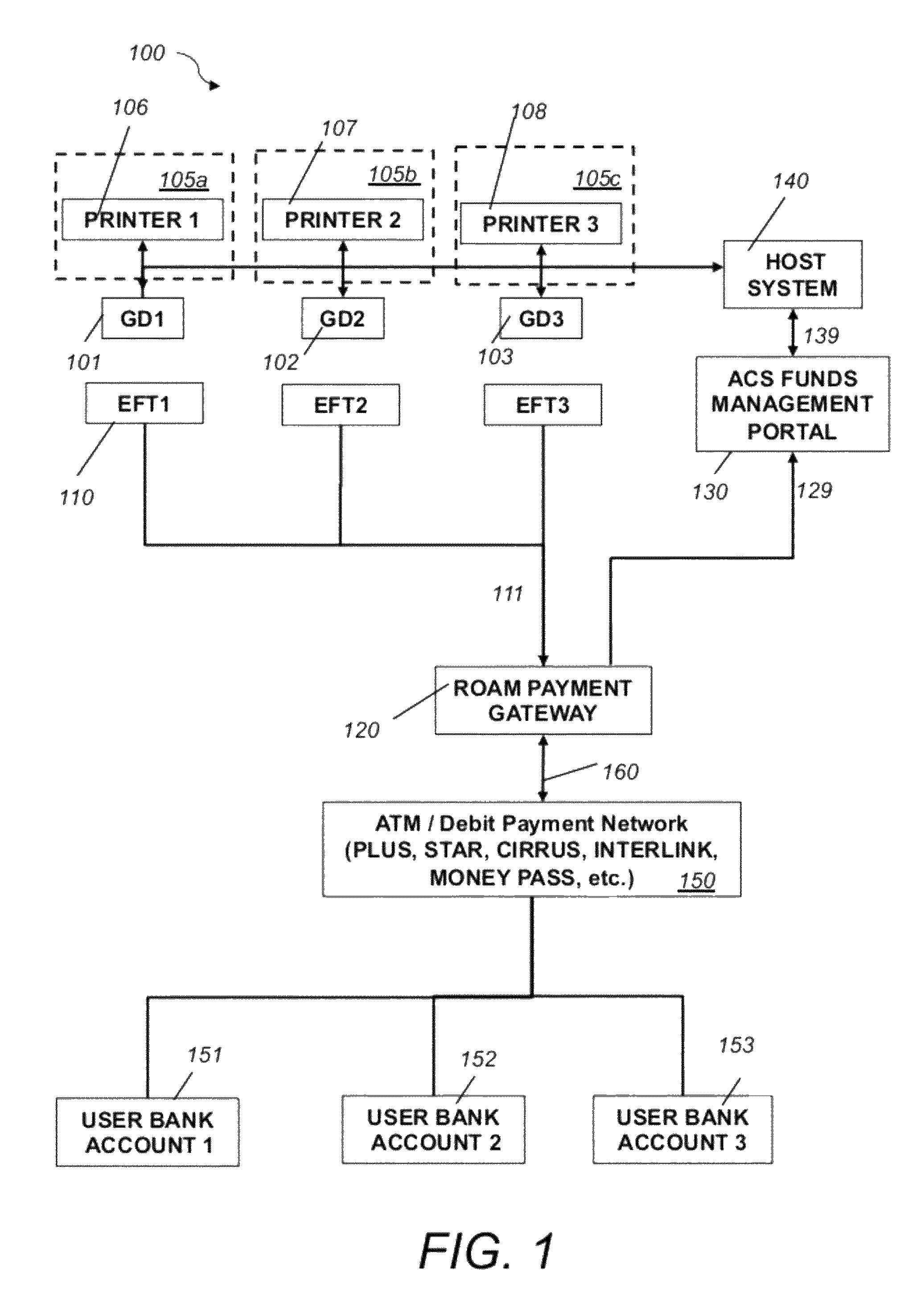

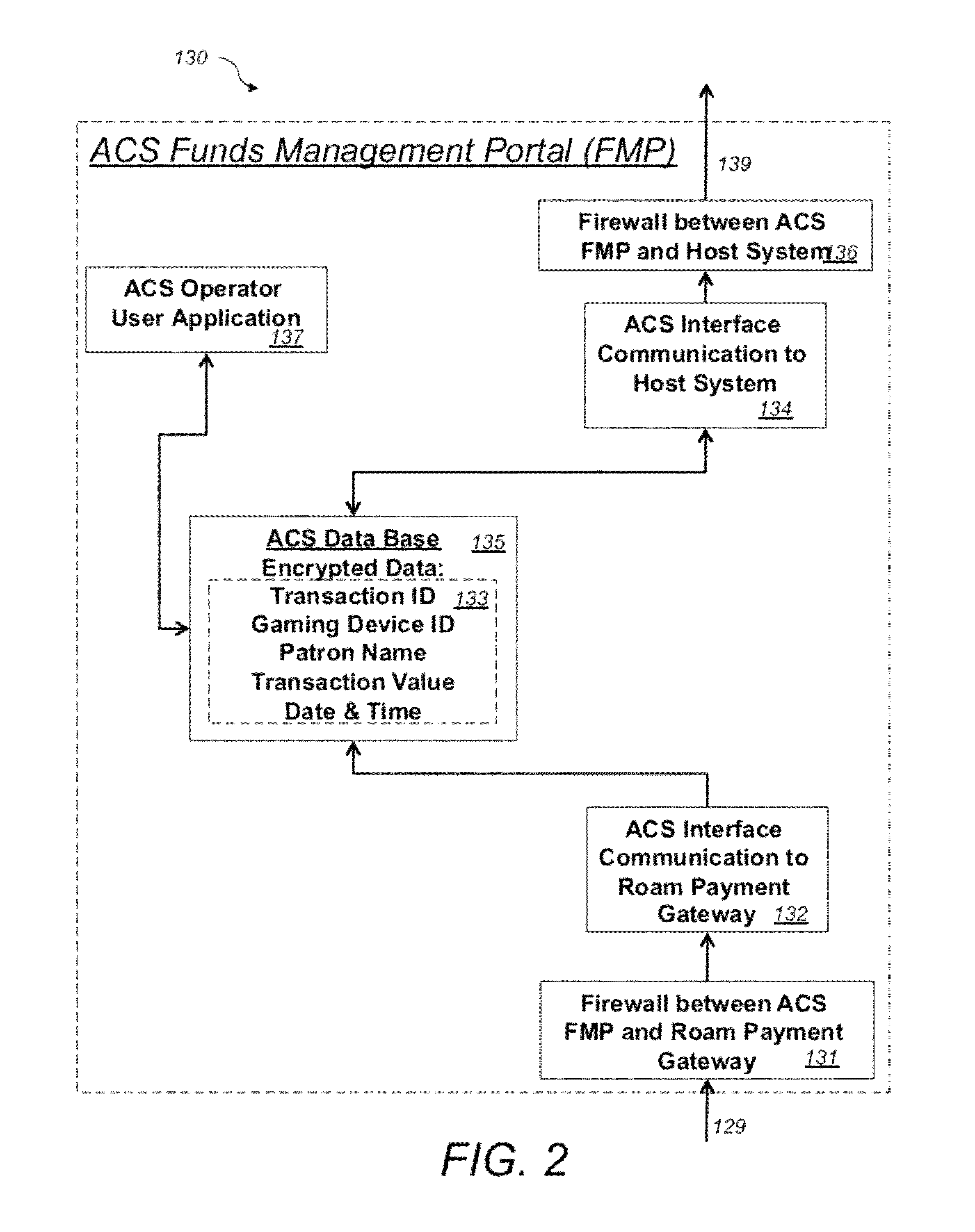

System and method for electronic fund transfers for use with gaming systems

An electronic fund transfer (EFT) system for managing and transferring electronic funds from a user's financial account to a credit system includes a credit system configured to dispense credit to a user via physical or electronic credit means, an electronic fund transfer (EFT) device, a secure payment gateway configured to connect to the user's financial accounts via a financial asynchronous transfer mode (ATM) network, a host system connected to the credit system via a local network, a funds management portal connected to the host system and the secure payment gateway, and means for transferring electronic funds from the user's financial account to the credit system via the secure payment gateway. The funds management portal accounts and reconciles the transferred electronic funds. All communications between the secure payment gateway and the host system pass through the funds management portal. The EFT device includes a secure client-side application for receiving instructions from the user for transferring electronic funds from the user's financial account to the credit system and means for transmitting the fund transfer instructions to the user's financial account. The EFT device is configured to connect to the secure payment gateway and to communicate with the user's financial account and to transmit the instructions for transferring electronic funds from the user's financial account to the credit system via the secure payment gateway.

Owner:AUTOMATED CASHLESS SYST INC

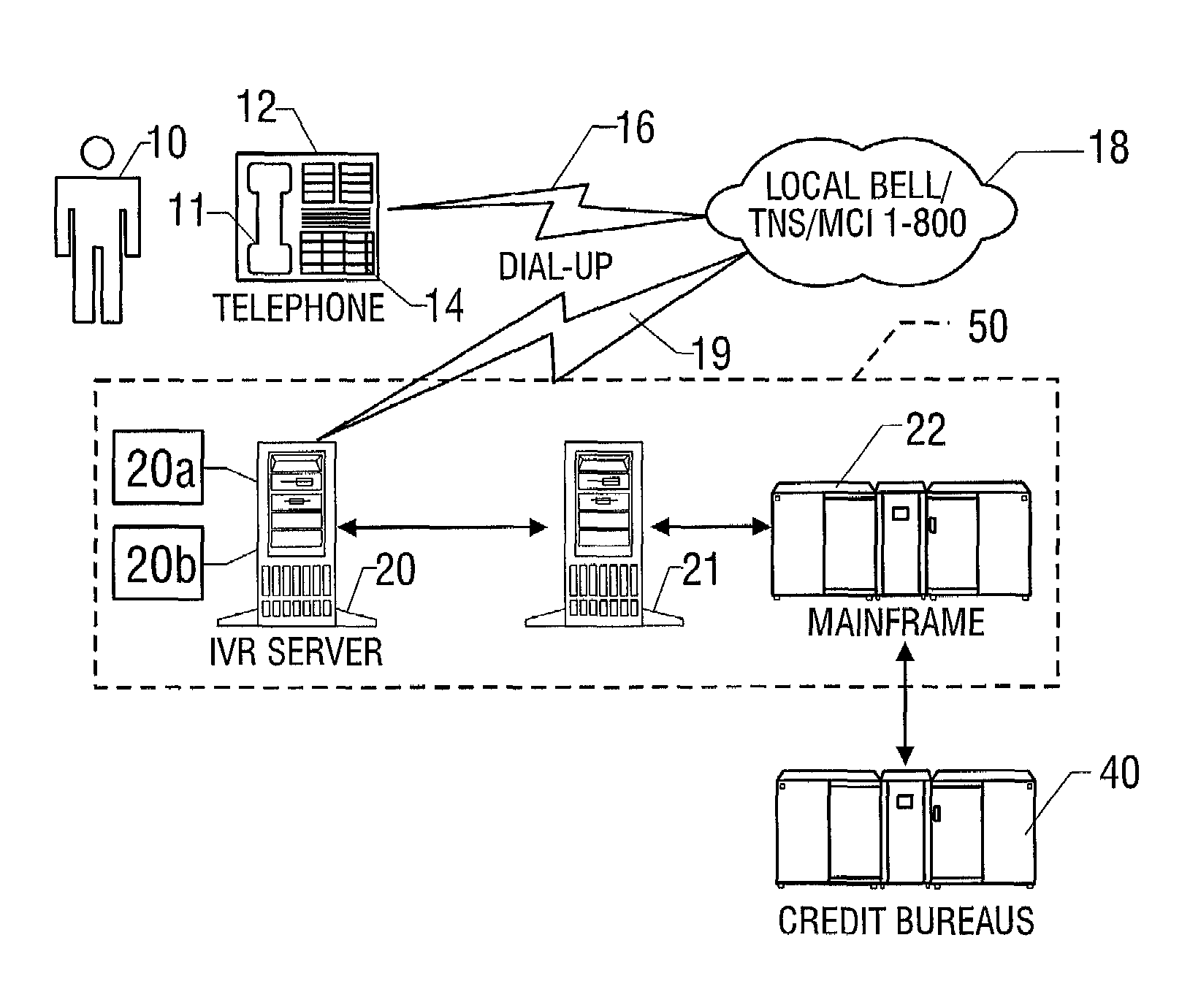

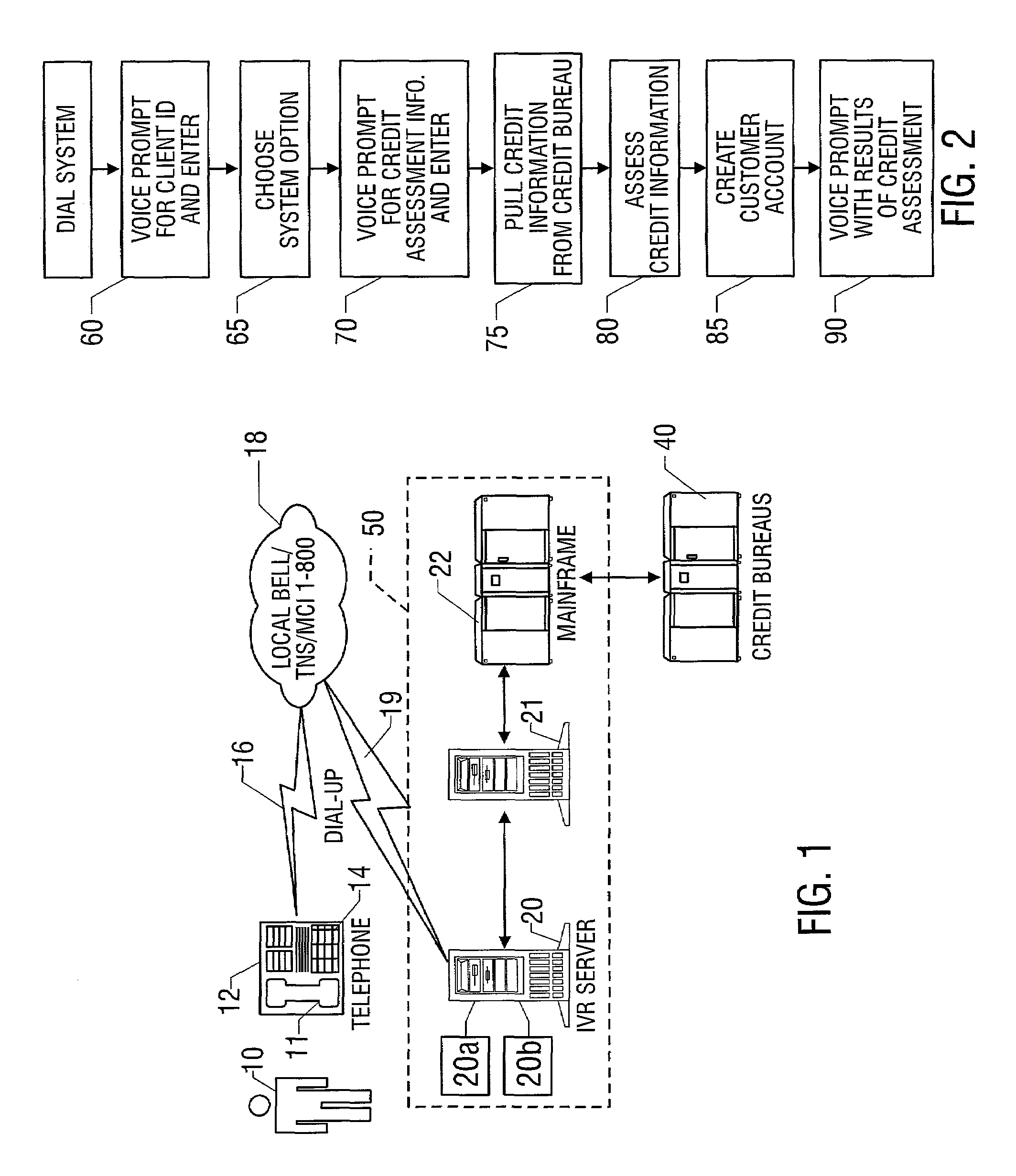

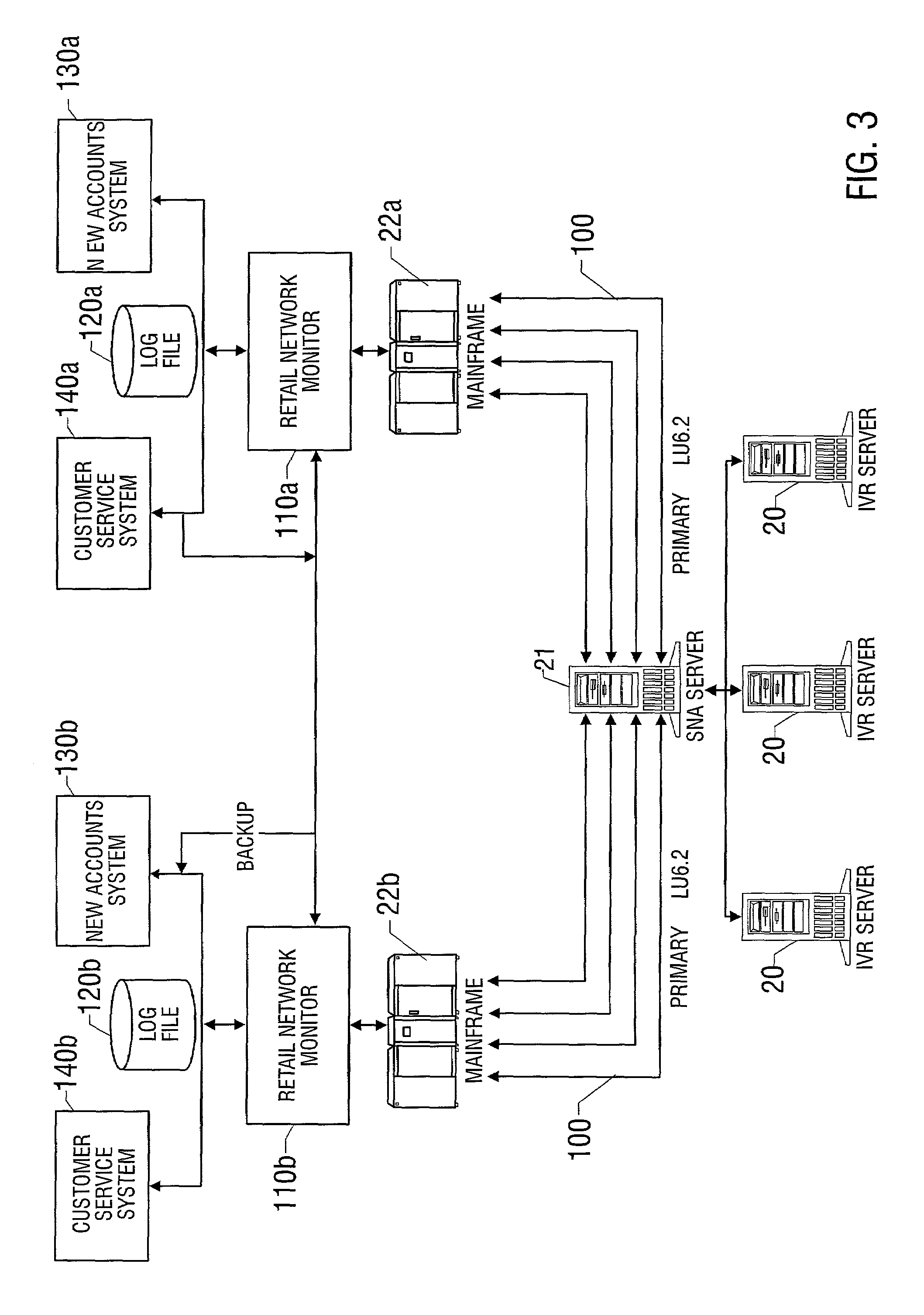

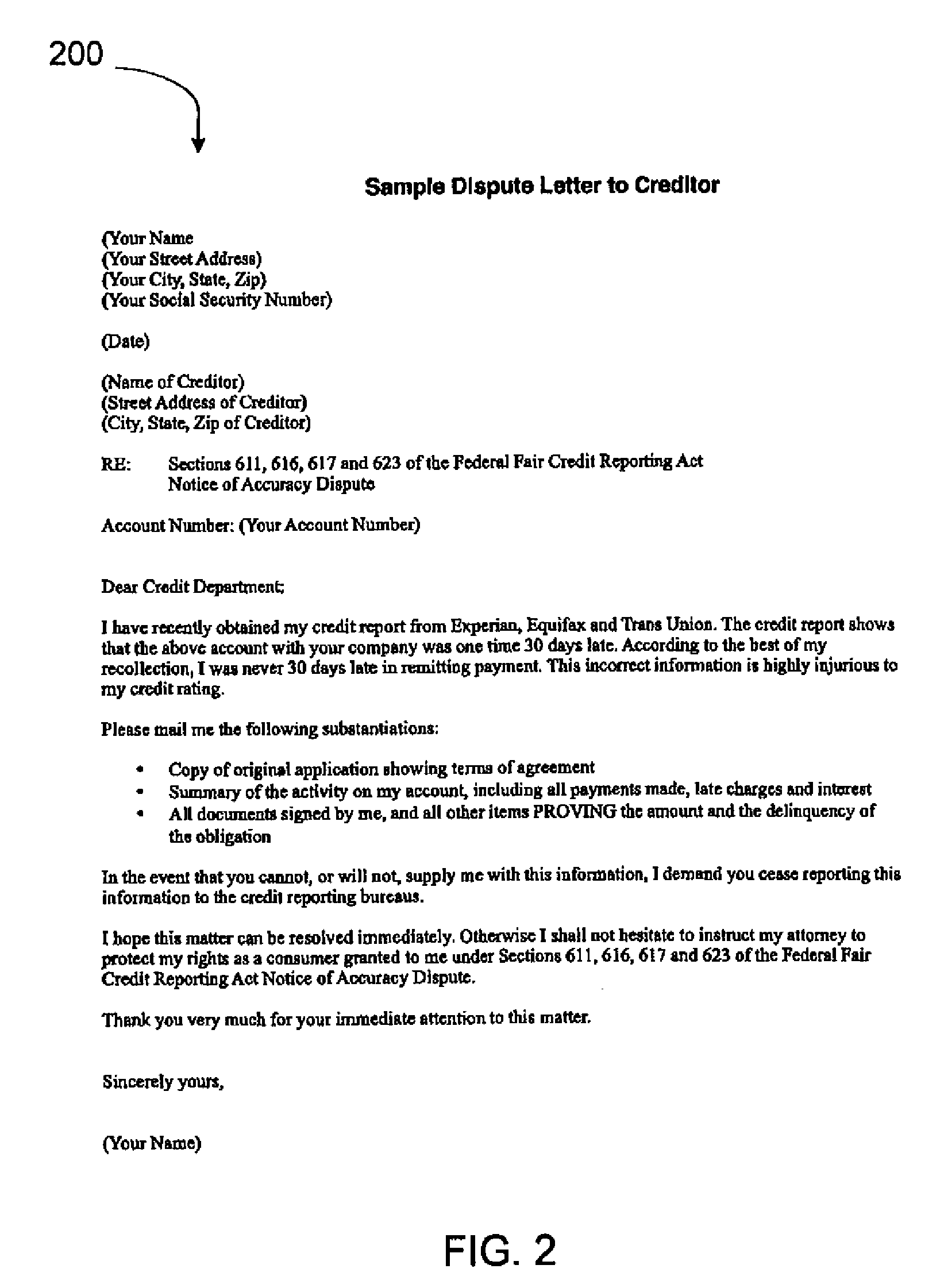

Interactive voice response quick credit system and associated methods

A system and method for applying for a credit card, preferably at a point of sale, is disclosed. The system employs an automated interactive voice response system preferably sponsored by a credit card issuer. The user calls into the system using a standard telephone, and enters credit assessment information about the customer using the key pad of the telephone in response to verbal questions posed by the system. In one embodiment, only numeric information concerning the customer is entered, such as the customer's social security number. This credit assessment information is used to retrieve a credit report or score from a credit bureau database, which is used by the system to electronically decide whether to issue credit and to what extent and to establish a customer account. The system verbally provides information to the user regarding the credit assessment so that the customer's credit purchase can be quickly consummated.

Owner:BREAD FINANCIAL PAYMENTS INC

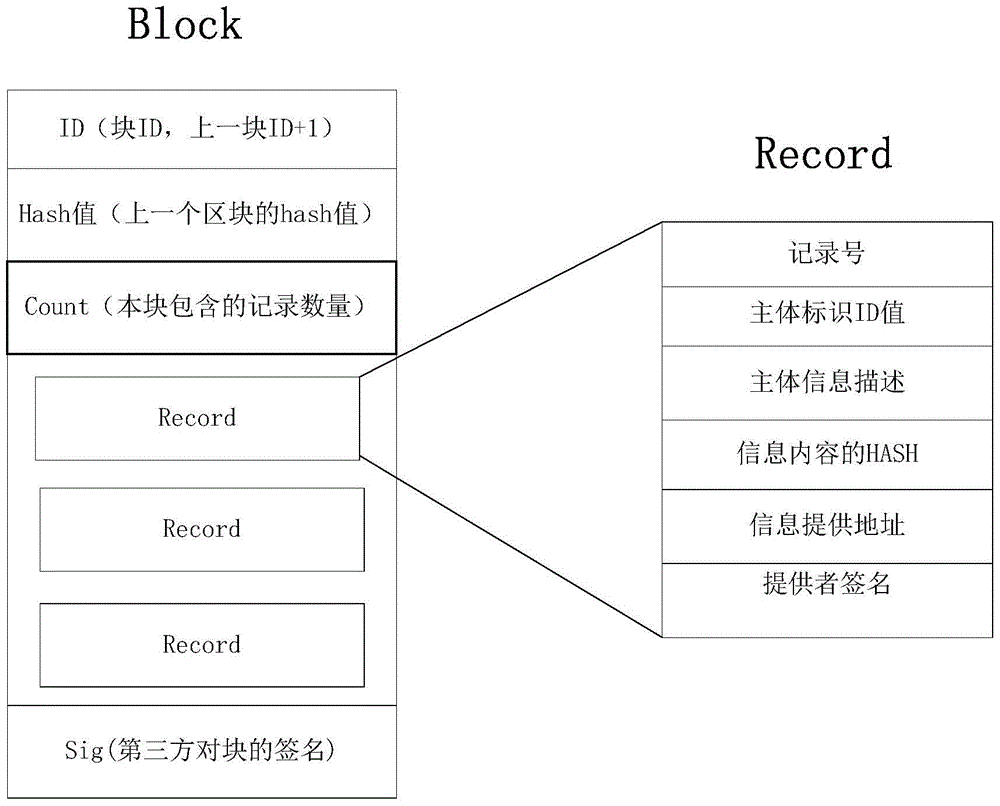

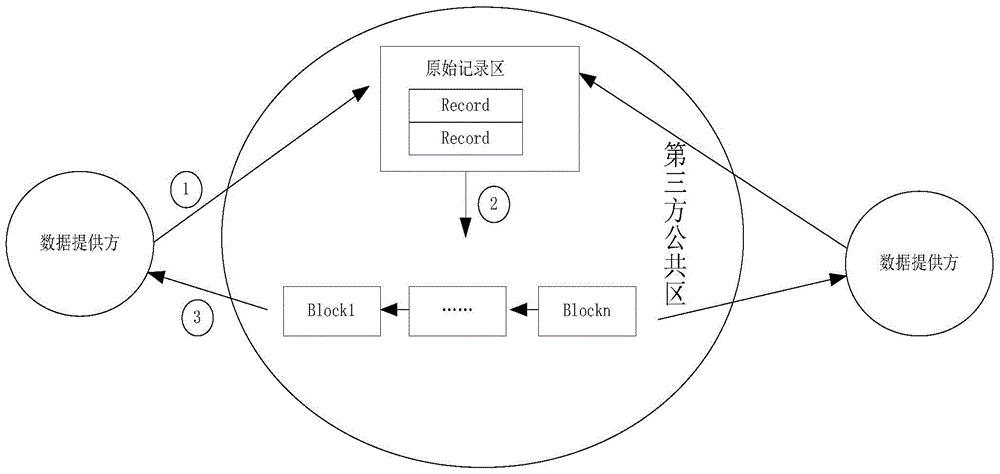

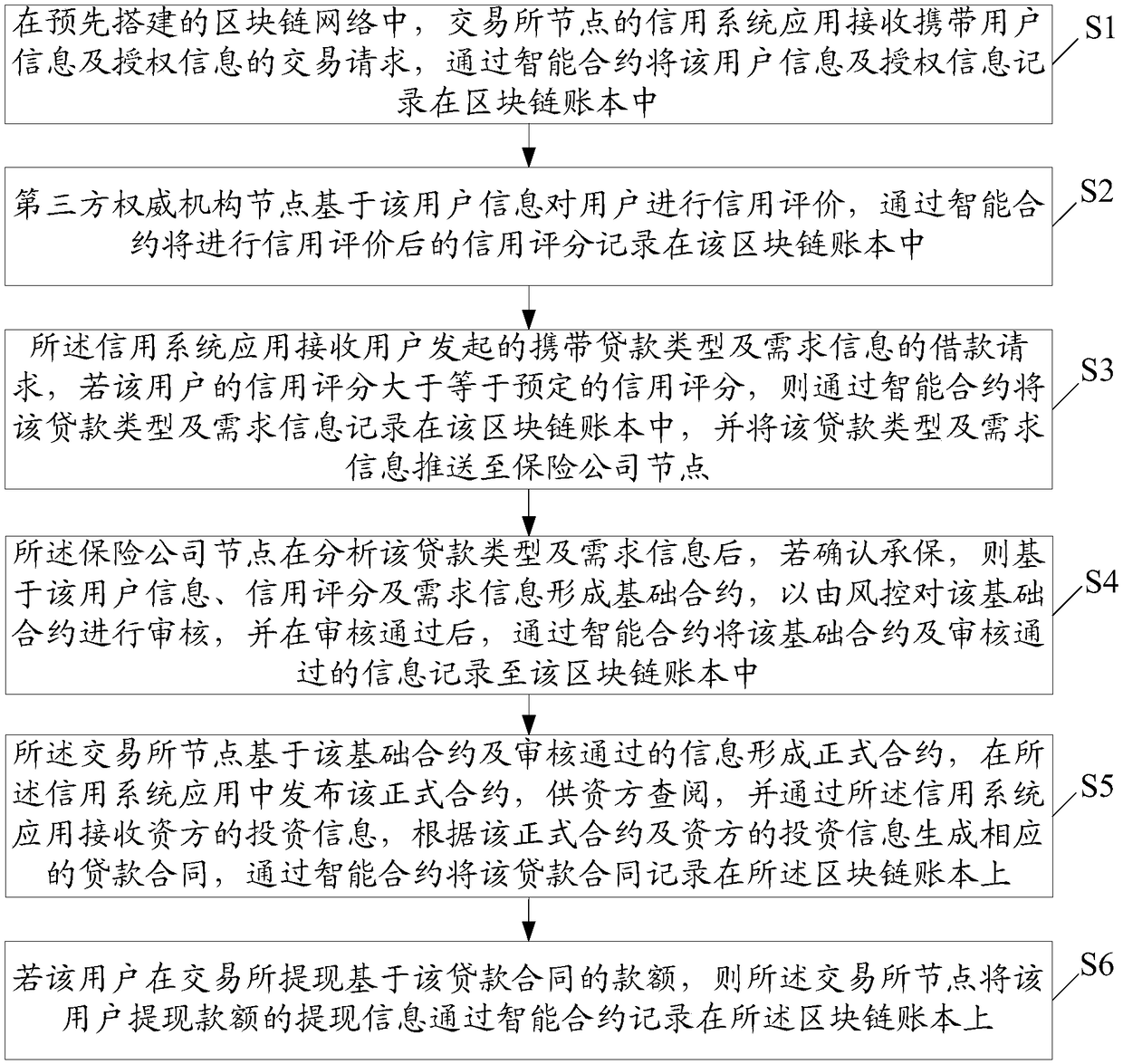

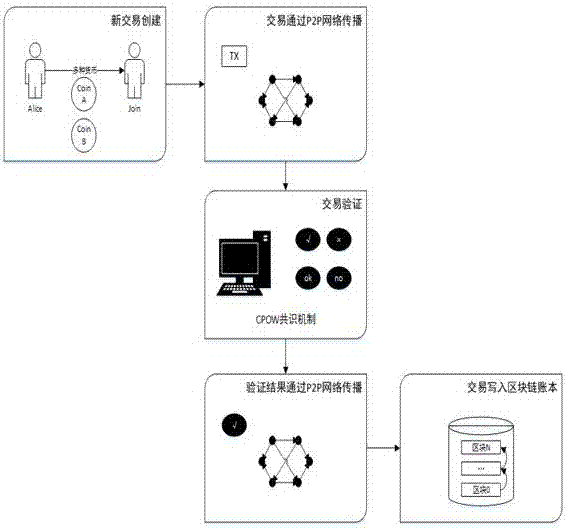

Multi-party co-construction credit record method based on block chains

ActiveCN105761143AGuarantee authenticityGuaranteed validityFinanceSpecial data processing applicationsCredit systemThird party

The present invention discloses a multi-party co-construction credit record method based on block chains. The roles participated in the whole credit system comprises a support third party and a data owner, the support third party is responsible for the building of a communication system and the formulation and the realization of the technology standard, and the data owner provides credit records. The multi-party co-construction credit record method based on block chains is able to completely record information which cannot be changed so as to ensure the authenticity of credit record, is able to complete multi-party construction together through a third party link, wherein the data provider does not need to provide original data in advance, and the data interaction is performed when the data is required, and are able to ensure the authenticity of data providers and the validity of data through digital signature.

Owner:SHANGHAI PINGAN NETWORK TECH CO LTD

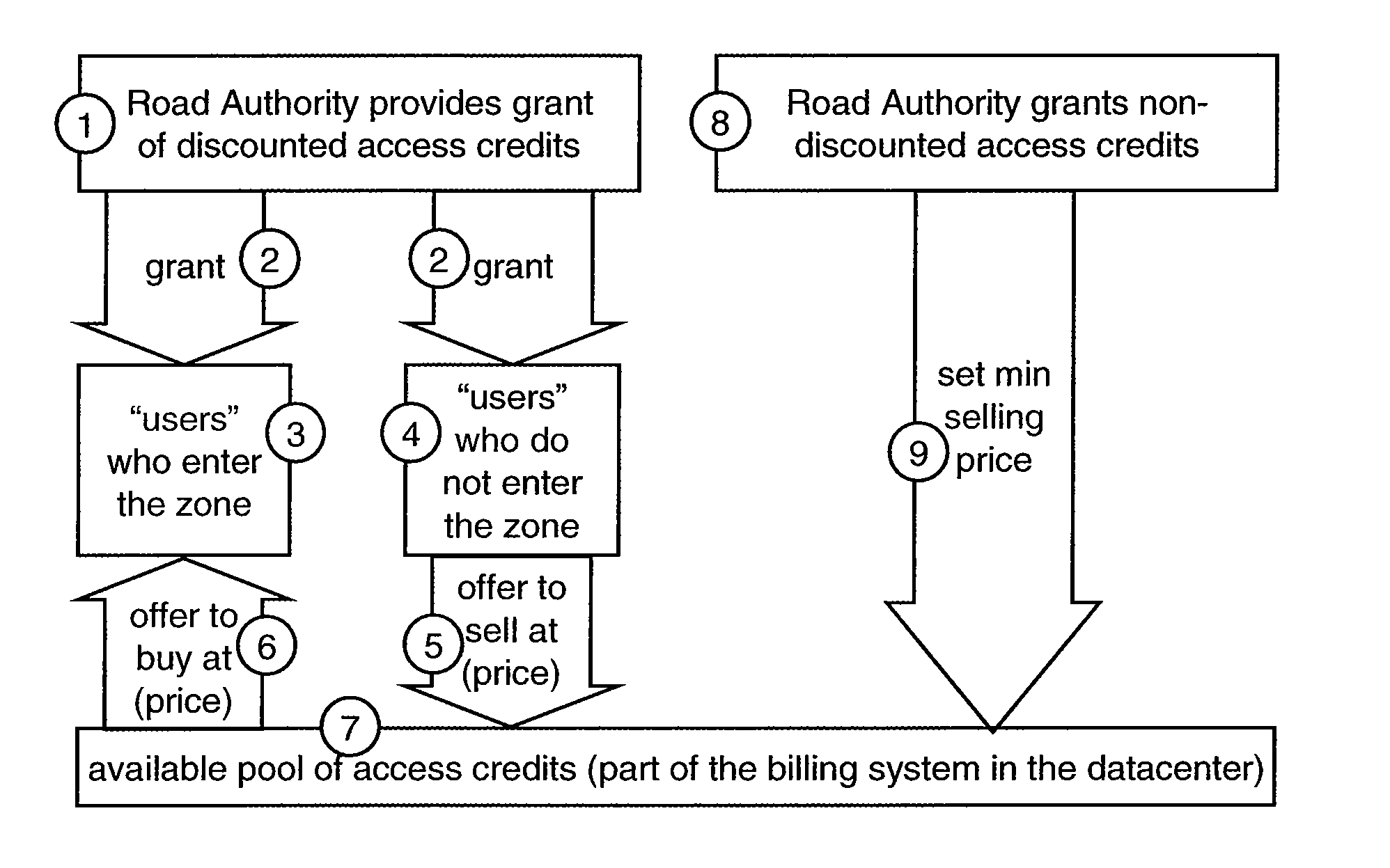

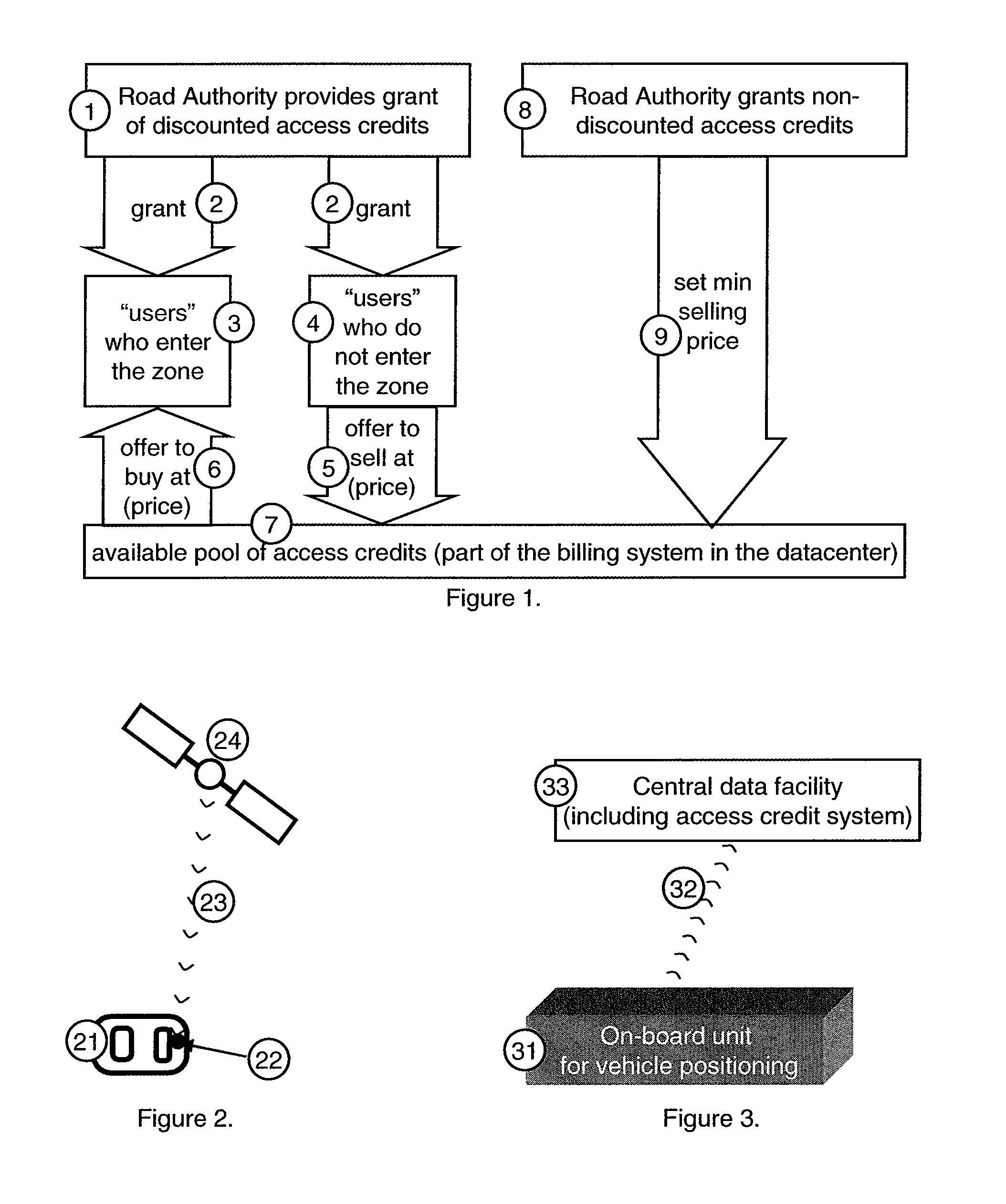

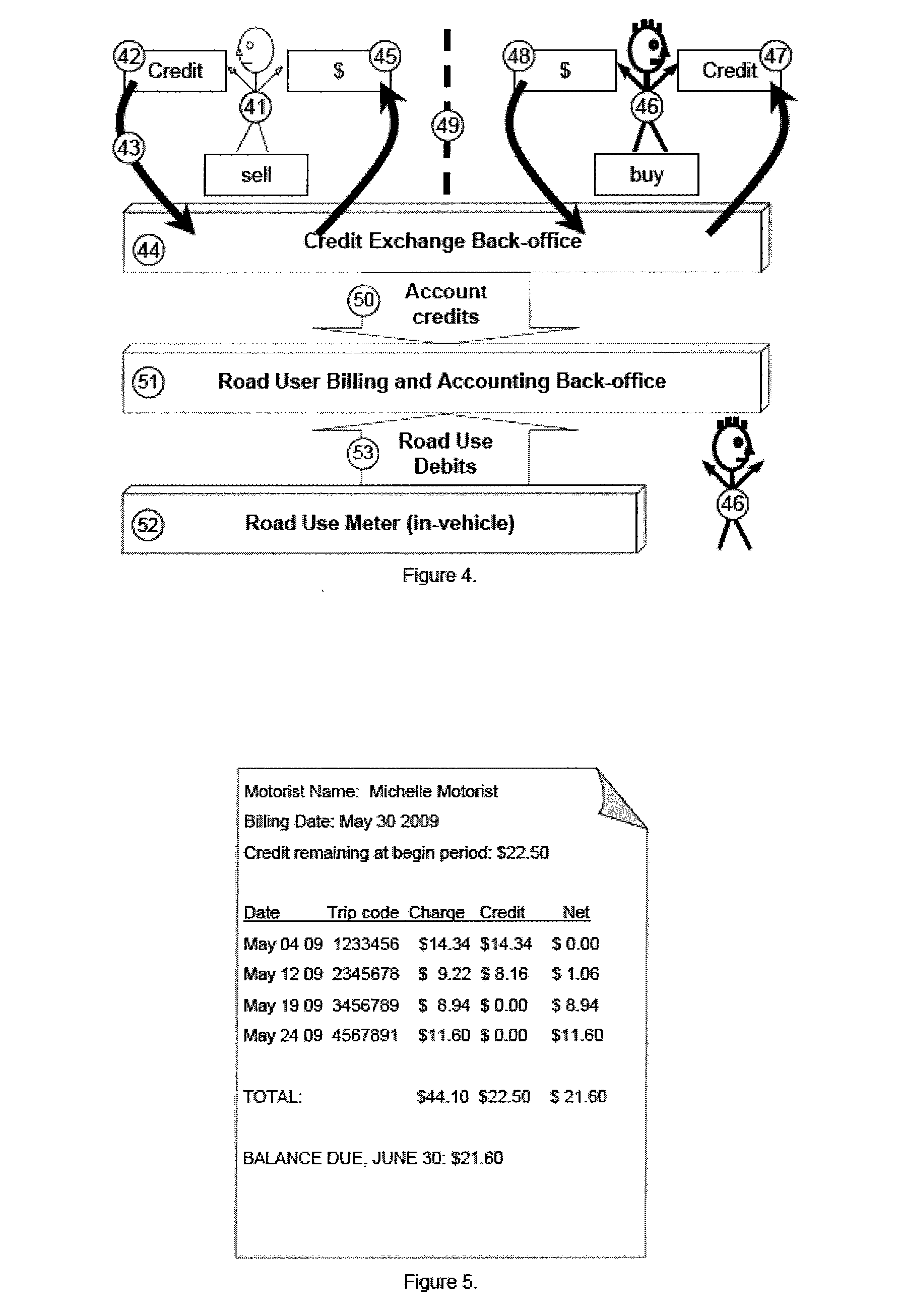

Method for road use credit tracking and exchange

The invention provides a method of administering a road use credit system. The method allows motorists to buy and sell road use credits. The road-use credits are redeemable for road use in a chargeable area. Motorists may be tracked by satellite using an on-board device to determine and calculate chargeable road use. A road use credit exchange is also provided.

Owner:GRUSH BERNARD

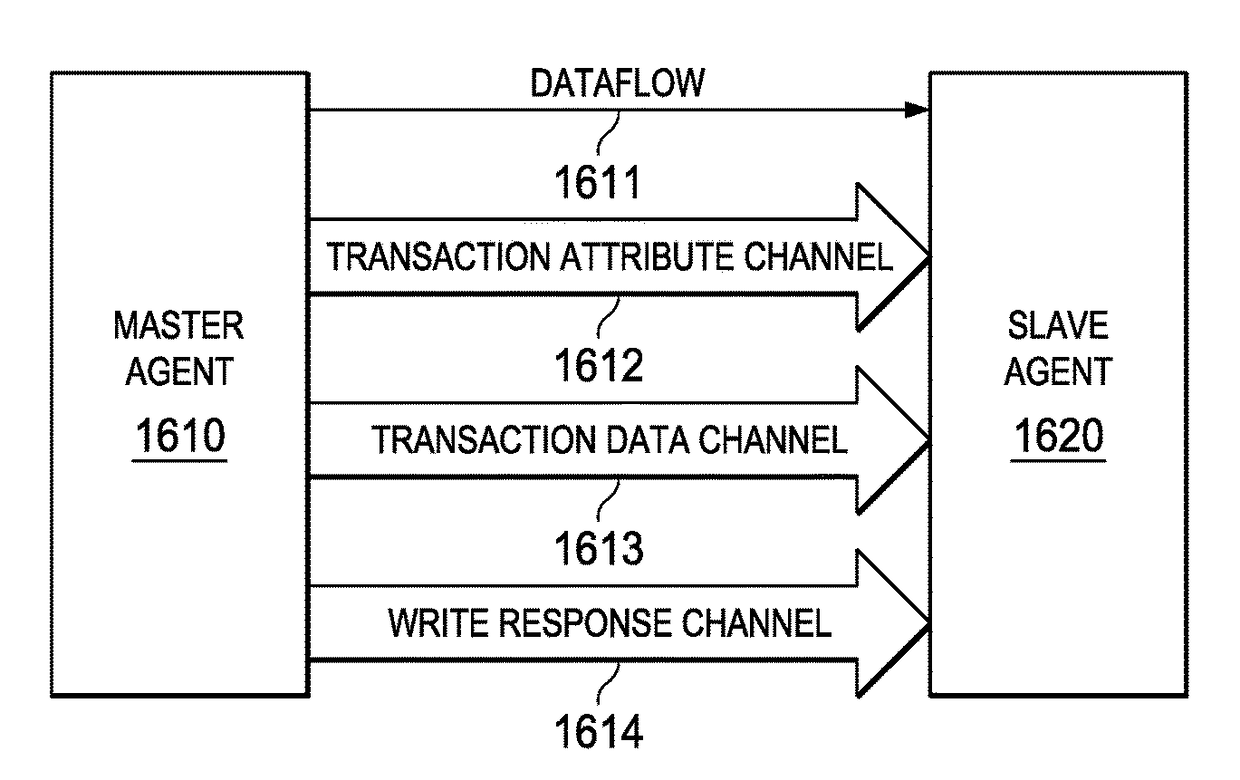

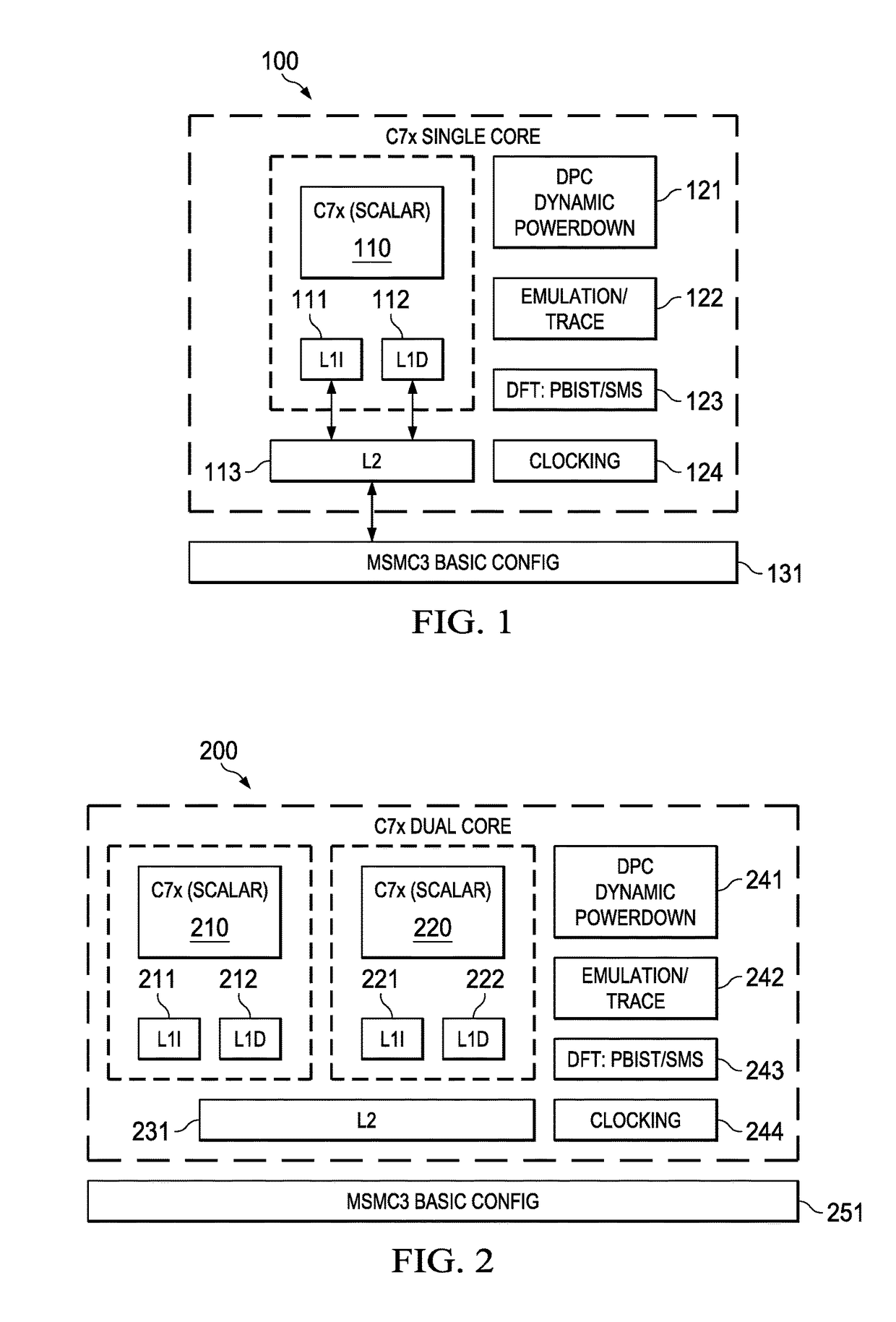

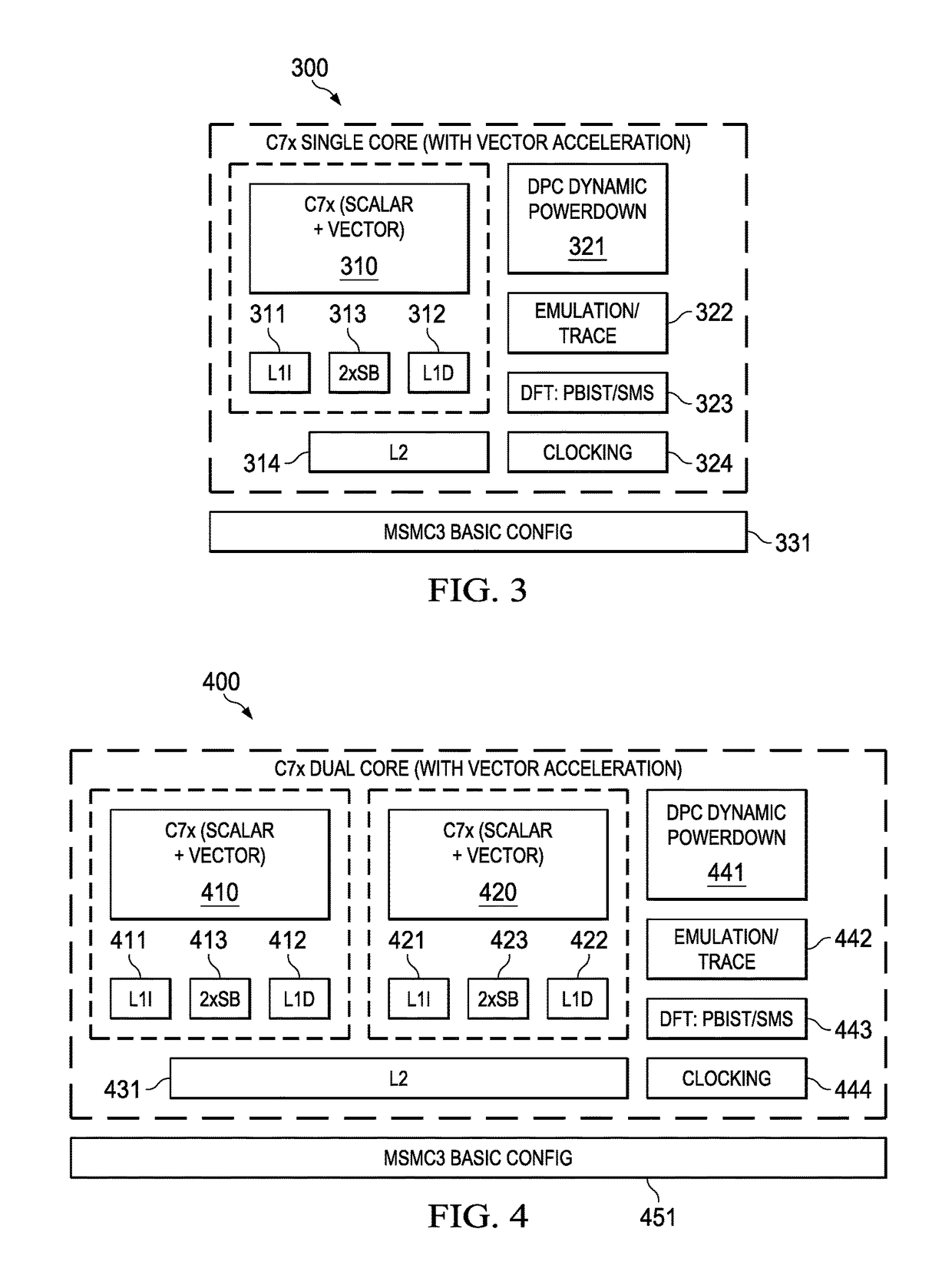

Multicore bus architecture with non-blocking high performance transaction credit system

ActiveUS9904645B2Data switching networksElectric digital data processingCredit systemEmbedded system

This invention is a bus communication protocol. A master device stores bus credits. The master device may transmit a bus transaction only if it holds sufficient number and type of bus credits. Upon transmission, the master device decrements the number of stored bus credits. The bus credits correspond to resources on a slave device for receiving bus transactions. The slave device must receive the bus transaction if accompanied by the proper credits. The slave device services the transaction. The slave device then transmits a credit return. The master device adds the corresponding number and types of credits to the stored amount. The slave device is ready to accept another bus transaction and the master device is re-enabled to initiate the bus transaction. In many types of interactions a bus agent may act as both master and slave depending upon the state of the process.

Owner:TEXAS INSTR INC

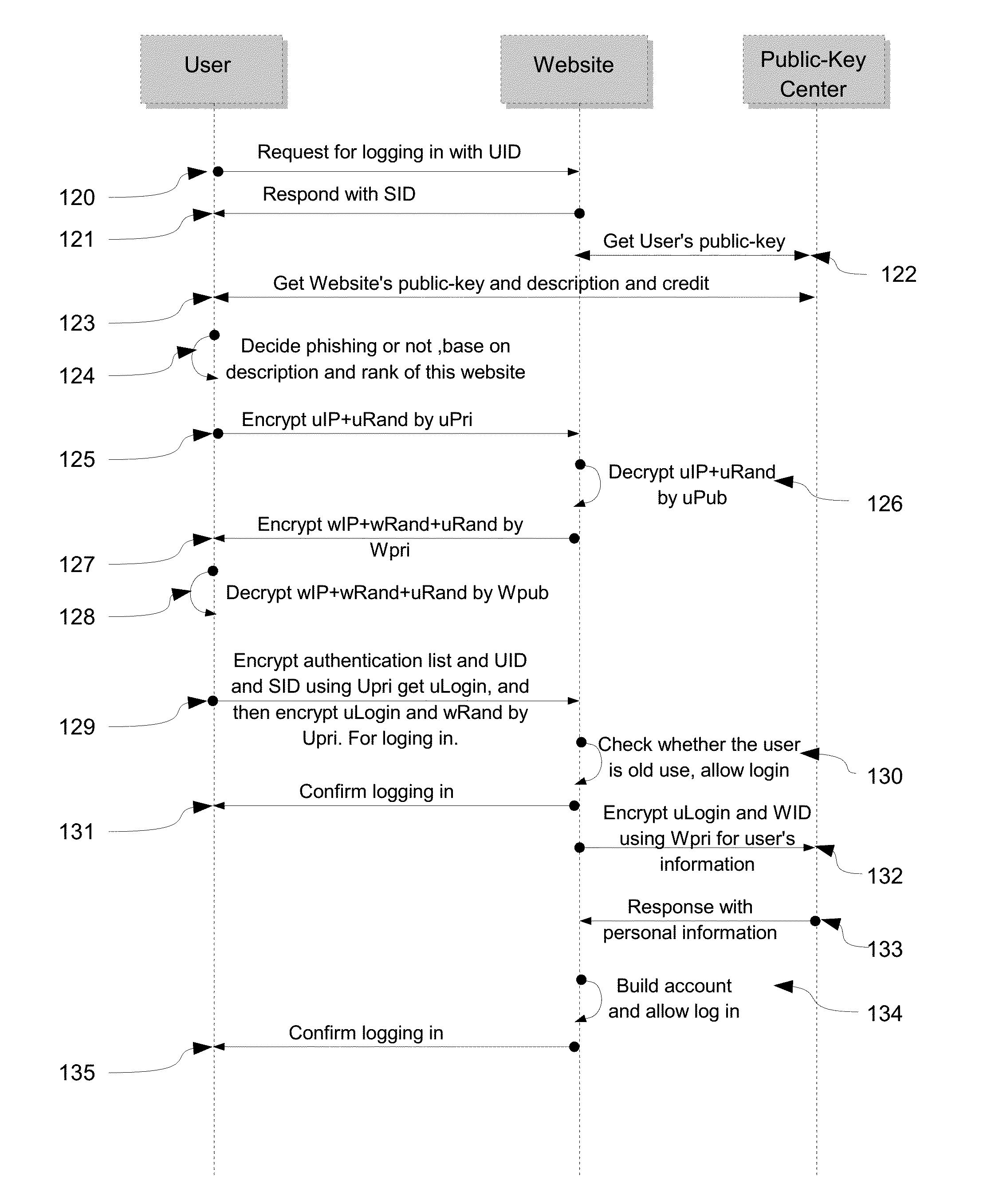

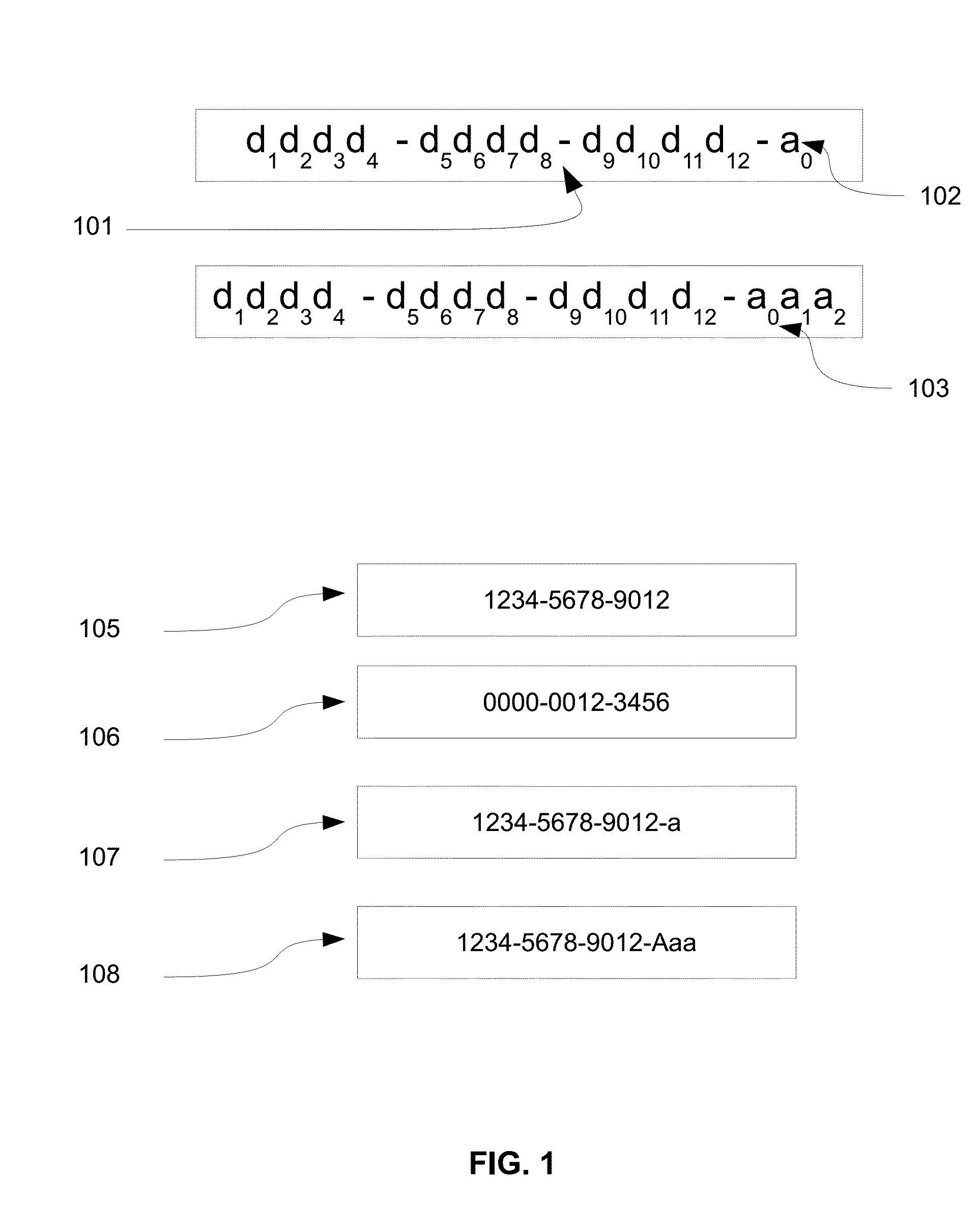

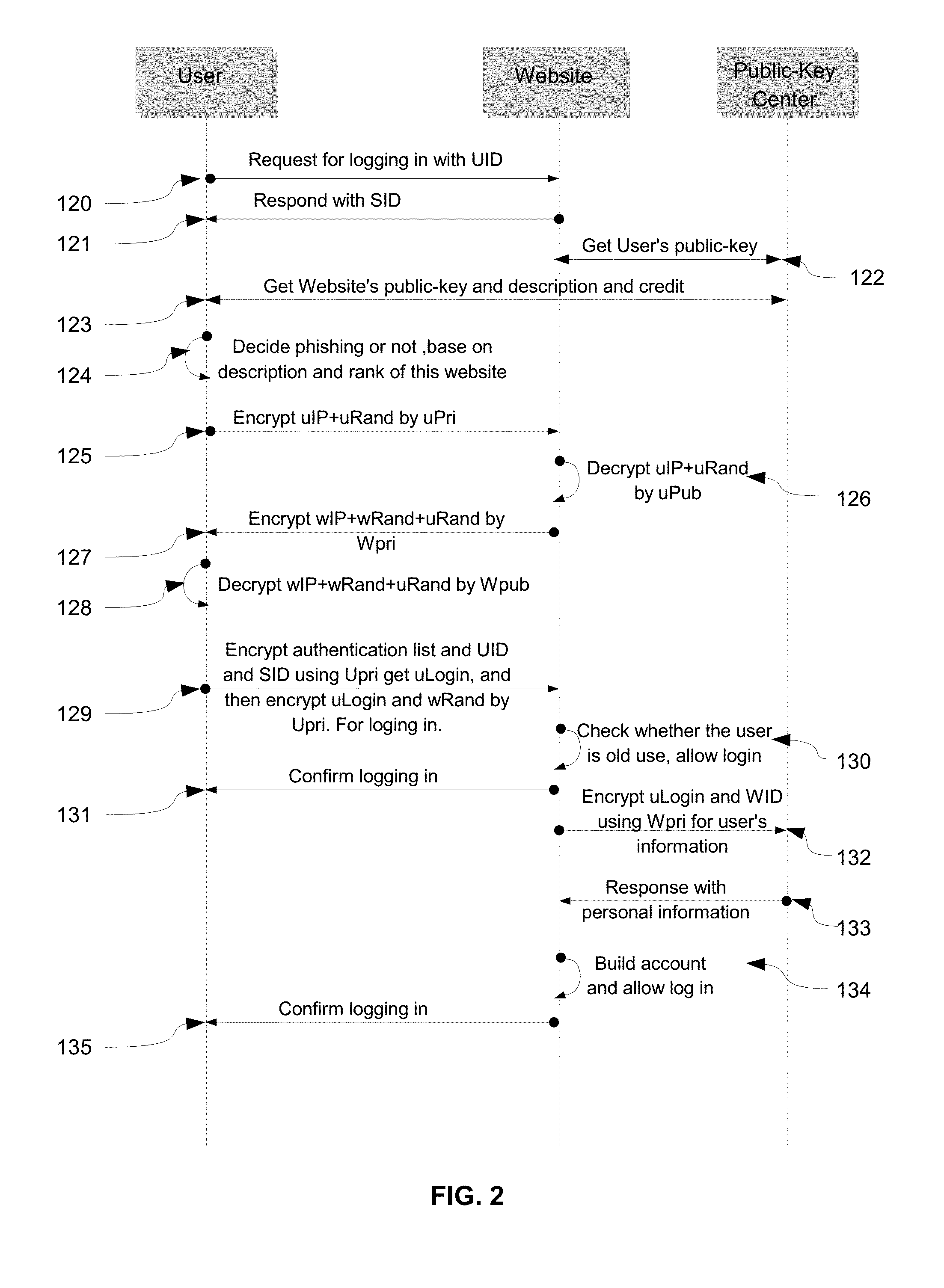

Secure way to build internet credit system and protect private information

InactiveUS20160192194A1Simple wayProtect their moneyUser identity/authority verificationSecurity arrangementCredit systemWeb site

A method includes building trust system among internet users, signing up in websites without password and protecting personal data in mobile device. Global Unique Identifier (GUID) is used to identify and accumulate internet credit for users and websites. First, user applies for GUID together with asymmetric-key, then the internet credit of this GUID can be accumulated based on transactions. Also, user can sign on or log in websites via GUID without using password and user name. In addition, dual data encryption and unpredictable random number is presented to anti-surveillance of communication. The personal information in mobile device are protected by asymmetric-key pairs and destroyed automatically after being stolen and mobile device's device-ID is used to chasing the stolen devices. In summary, the present invention is a securer way to build a trust system among internet users and protect data in mobile device.

Owner:YANG GONGMING

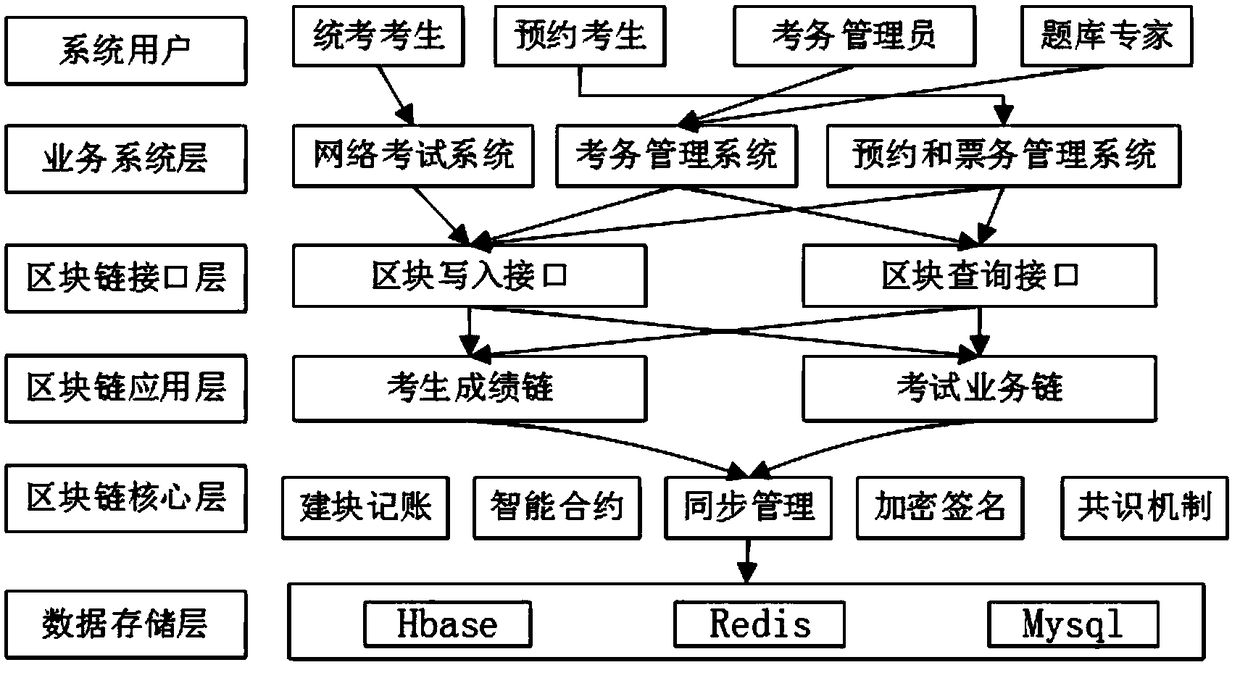

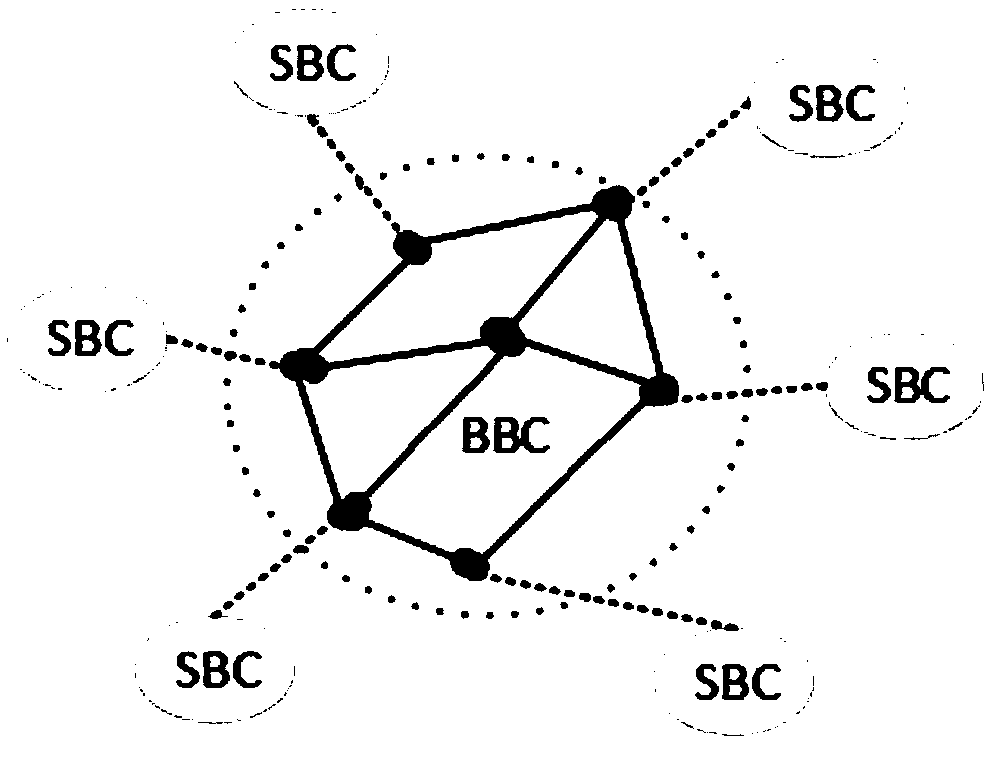

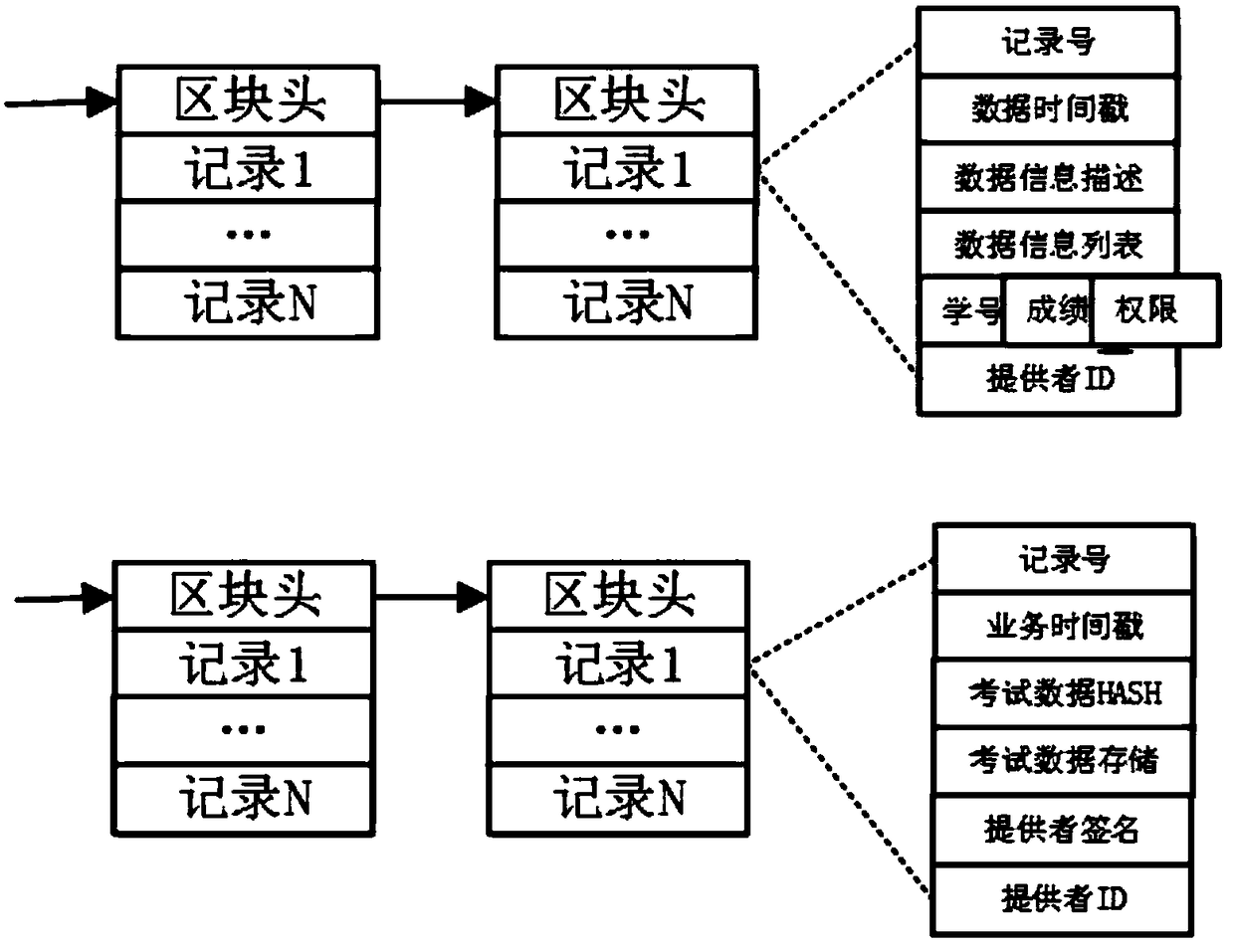

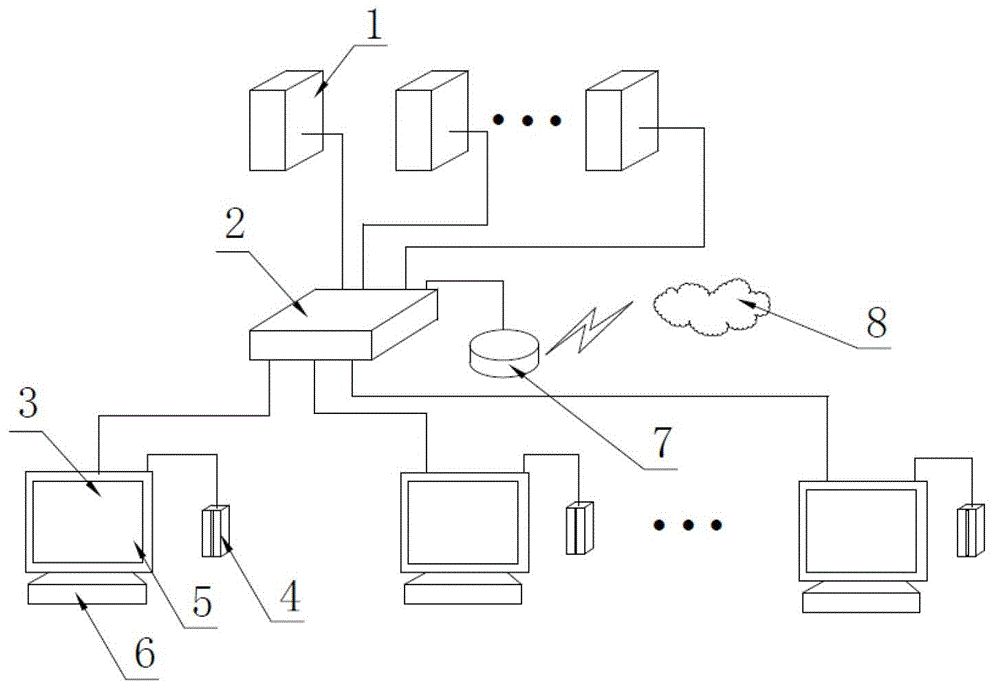

A network examination system based on a block chain and a method for managing the network examination by using the network examination system

ActiveCN109002527AAvoid lossPrevent malicious tamperingData processing applicationsSpecial data processing applicationsCredit systemManagement process

The invention relates to a network examination system based on a block chain and a method for managing the network examination by using the network examination system, belonging to the technical fieldof teaching management equipment. The system adopts double-block chain design, including a data storage layer, a block chain core layer, a block chain application layer, a block link interface layer,a business system layer and a system user layer. The API interface of the data storage layer is connected with the API interface of the core layer of the block chain, the core layer of the block chain is connected with the application layer of the block chain, and the application layer of the block chain is connected with the interface layer of the block link through the API interface. The blocklink interface layer is connected with the service system layer to realize the inquiry and writing of the block chain service. The business system layer is connected with the system user layer, whichprovides the interface between the user and the network examination service. The invention can prevent information from being lost or tampered with maliciously, construct a safe, reliable and non-tamper examination credit system, simplify the network examination management process, improve the network examination organization efficiency, and provide high-efficiency, convenient and humanized examination service for examinees.

Owner:JIANGSU OPEN UNIV

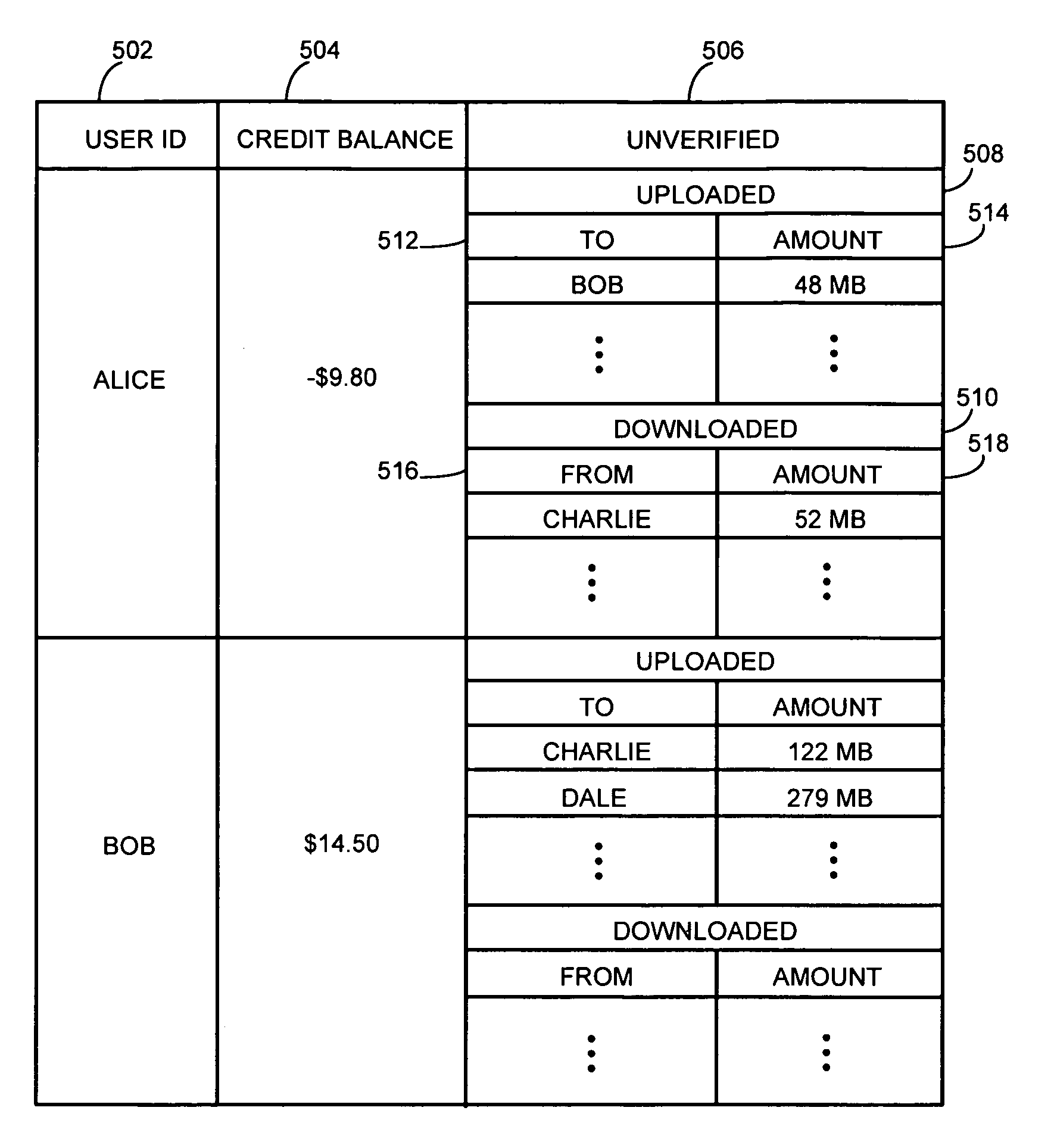

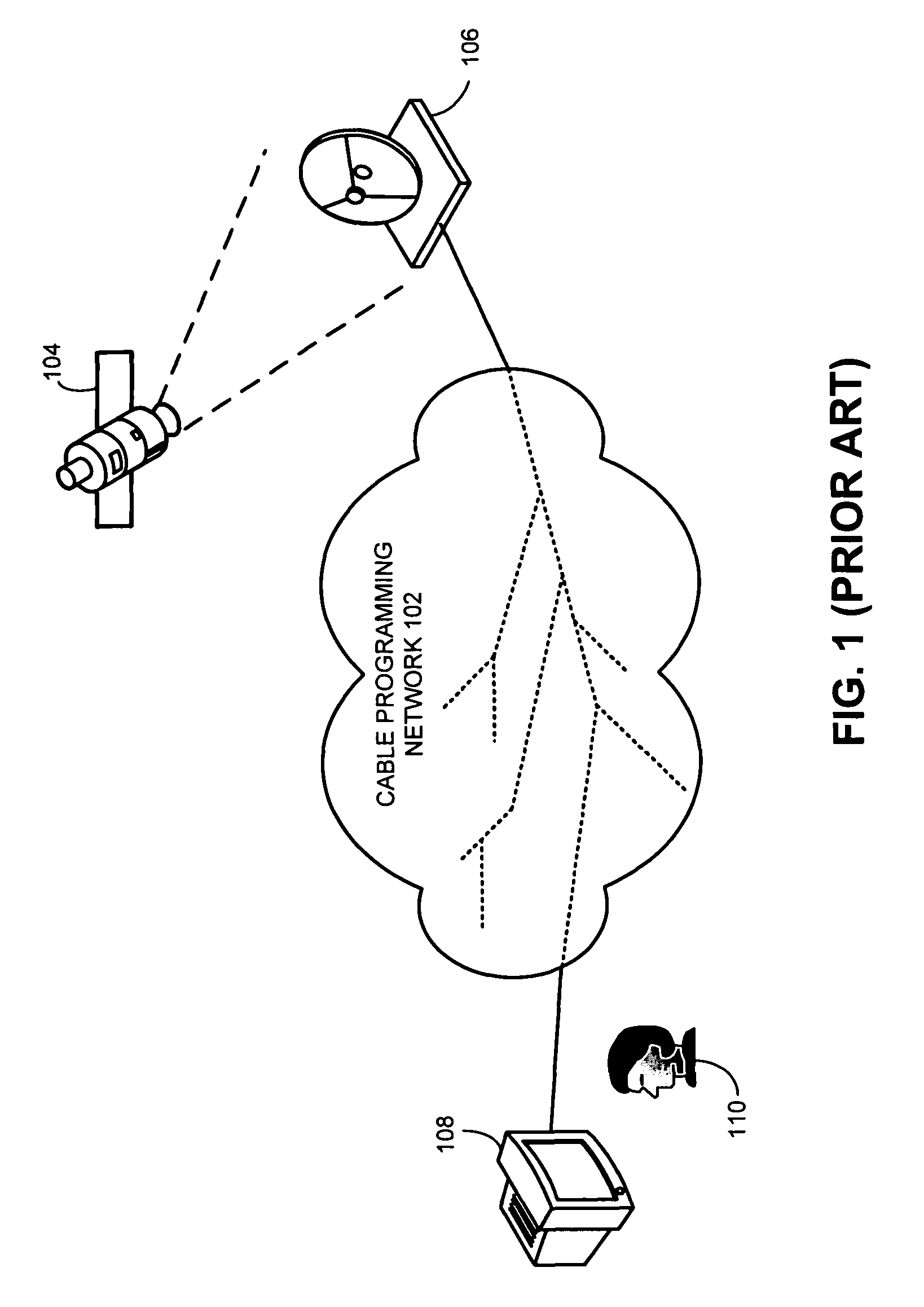

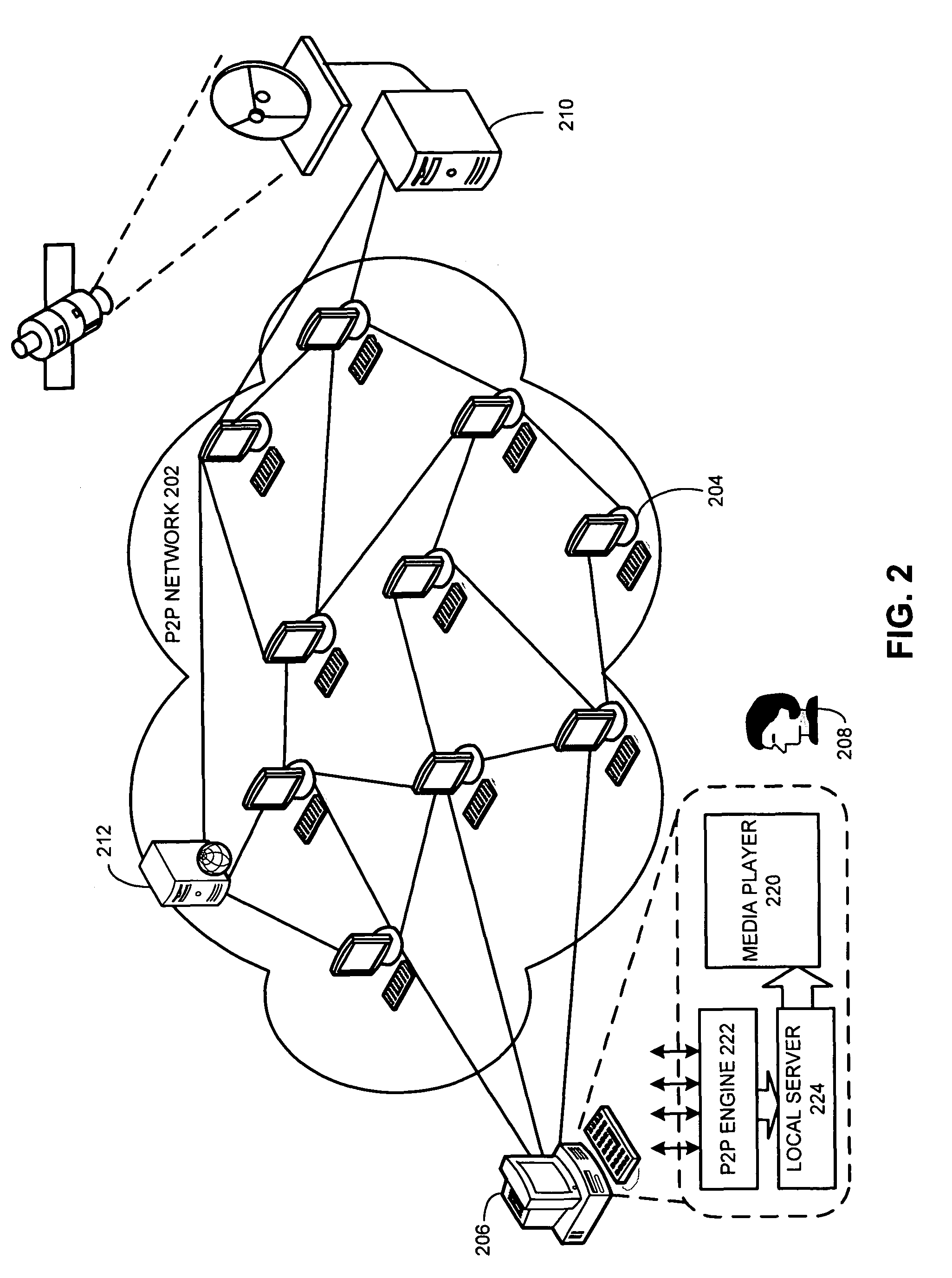

System and method for facilitating a credit system in a peer-to-peer content delivery network

InactiveUS7937362B1Encourage data sharingDigital data processing detailsSpecial data processing applicationsCredit systemPeering

A system and method facilitate a credit system for providing user incentives to encourage data sharing in a P2P network. The credit system maintains a user credit database and respectively increases or decreases a user's credits based on the data uploaded to or downloaded from other peer nodes. The credit system can also associate a user's credits with economic value or rewards to encourage the user to share data with other peer nodes. In one embodiment, the credit system maintains a credit record for each user. The credit system increases the credit for a user based on the amount of data a peer node associated with the user uploads to other peer nodes in the P2P network. The credit system also decreases the credit for the user based on the amount of data downloaded by the peer node associated with the user.

Owner:TV BANK

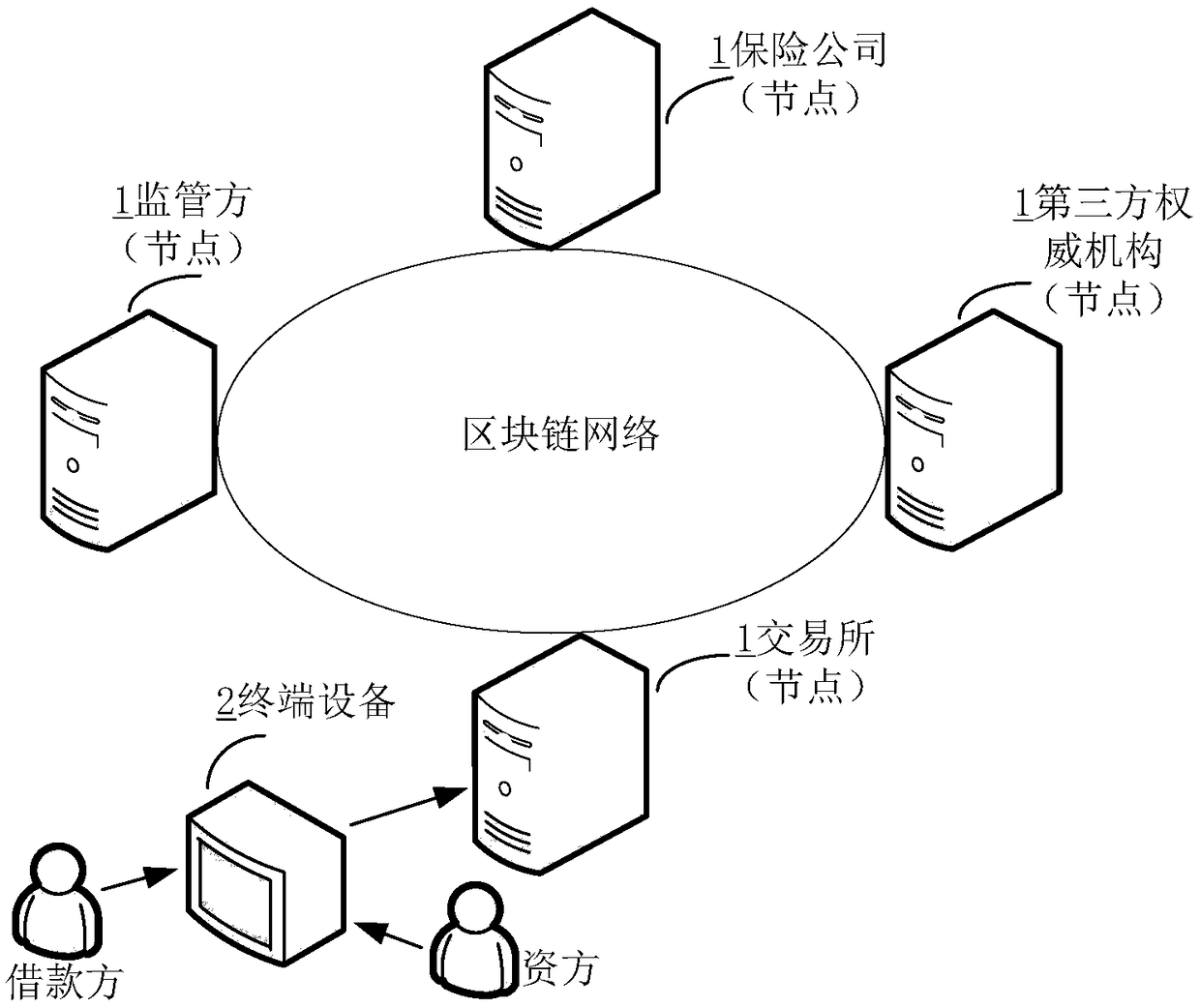

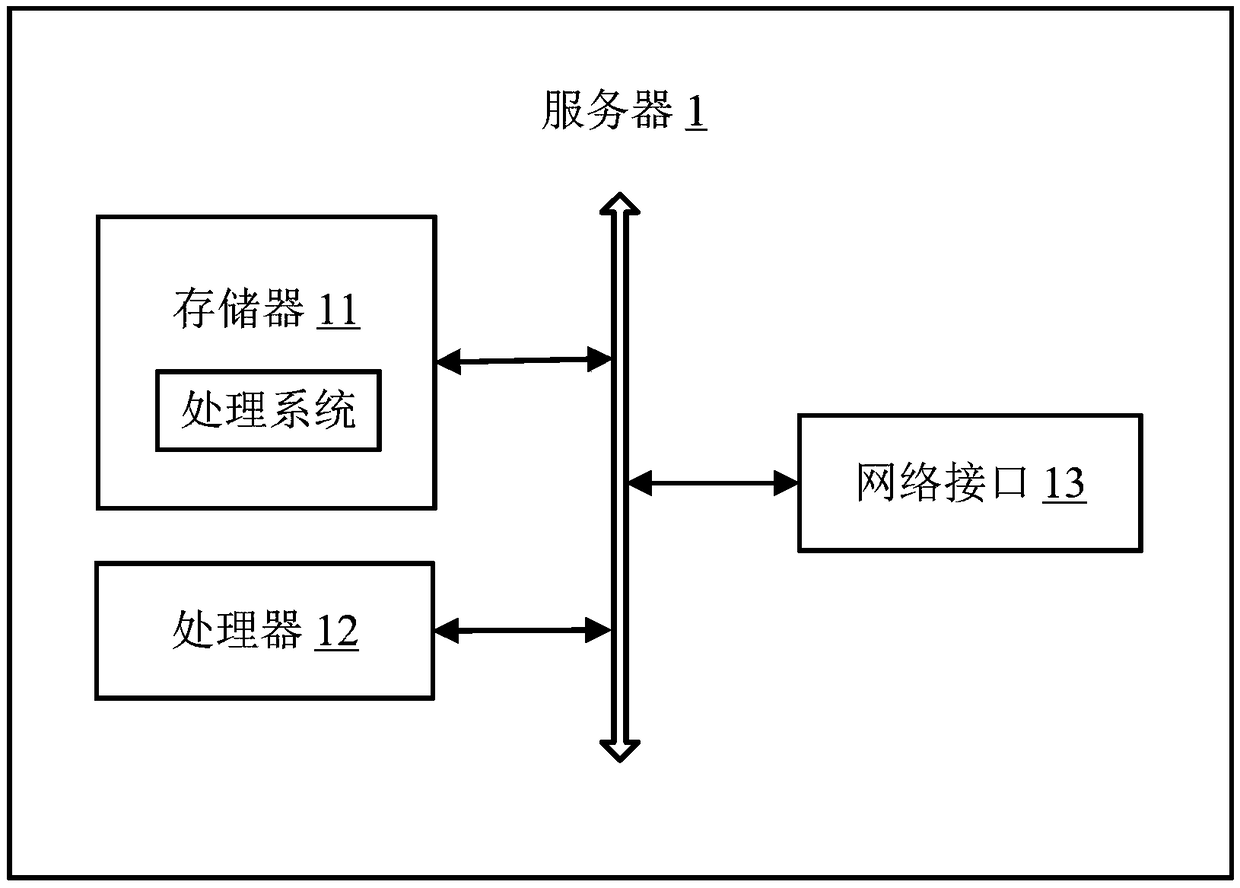

Block-chain-based lending and borrowing operation method, system, server and storage medium

The invention relates to technology of block chain and discloses A debit and credit operation method based on block chain and system, server and storage medium, The method comprises the following steps: in a block chain network, a credit system application of an exchange receives a transaction request, a third-party authority evaluates the credit of the user, and the credit system application receives a loan request initiated by the user. If the credit score of the user is greater than or equal to a predetermined credit score, the loan type and demand information are recorded in the block chain; and if the credit score of the user is greater than or equal to a predetermined credit score, the loan type and demand information are recorded in the block chain. The node of the insurance companyevaluates whether or not the insurance is underwritten. If the insurance is underwritten, the basic contract is formed. The node of the exchange generates a formal contract based on the basic contract and the information approved by the risk control review, releases the formal contract for the management to consult. If the management determines to invest, the loan contract is generated. After theloan contract becomes effective, the user withdraws the amount in the exchange. The invention can simplify the loan operation, shorten the overall loan efficiency and save the loan cost of the user.

Owner:PING AN TECH (SHENZHEN) CO LTD

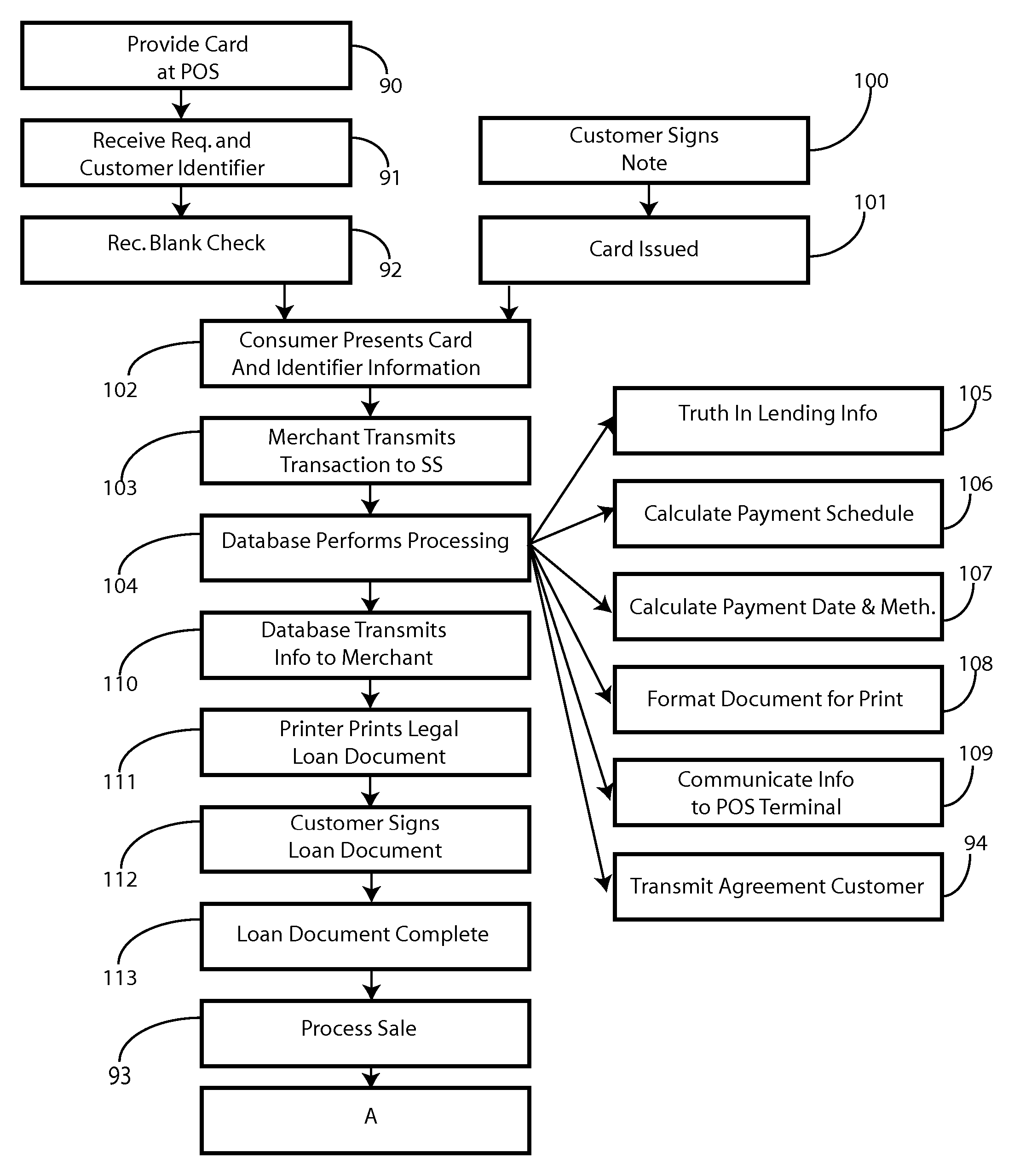

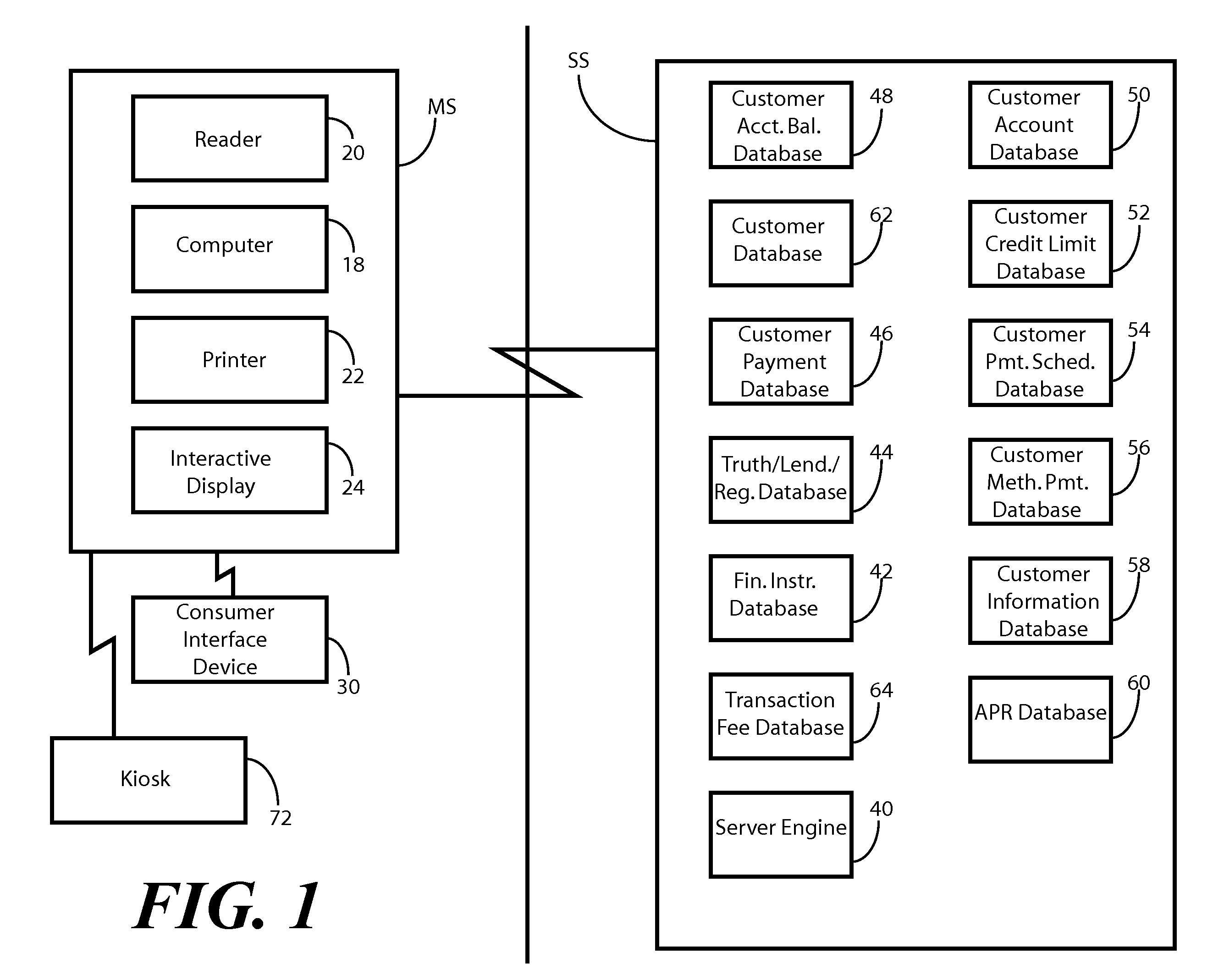

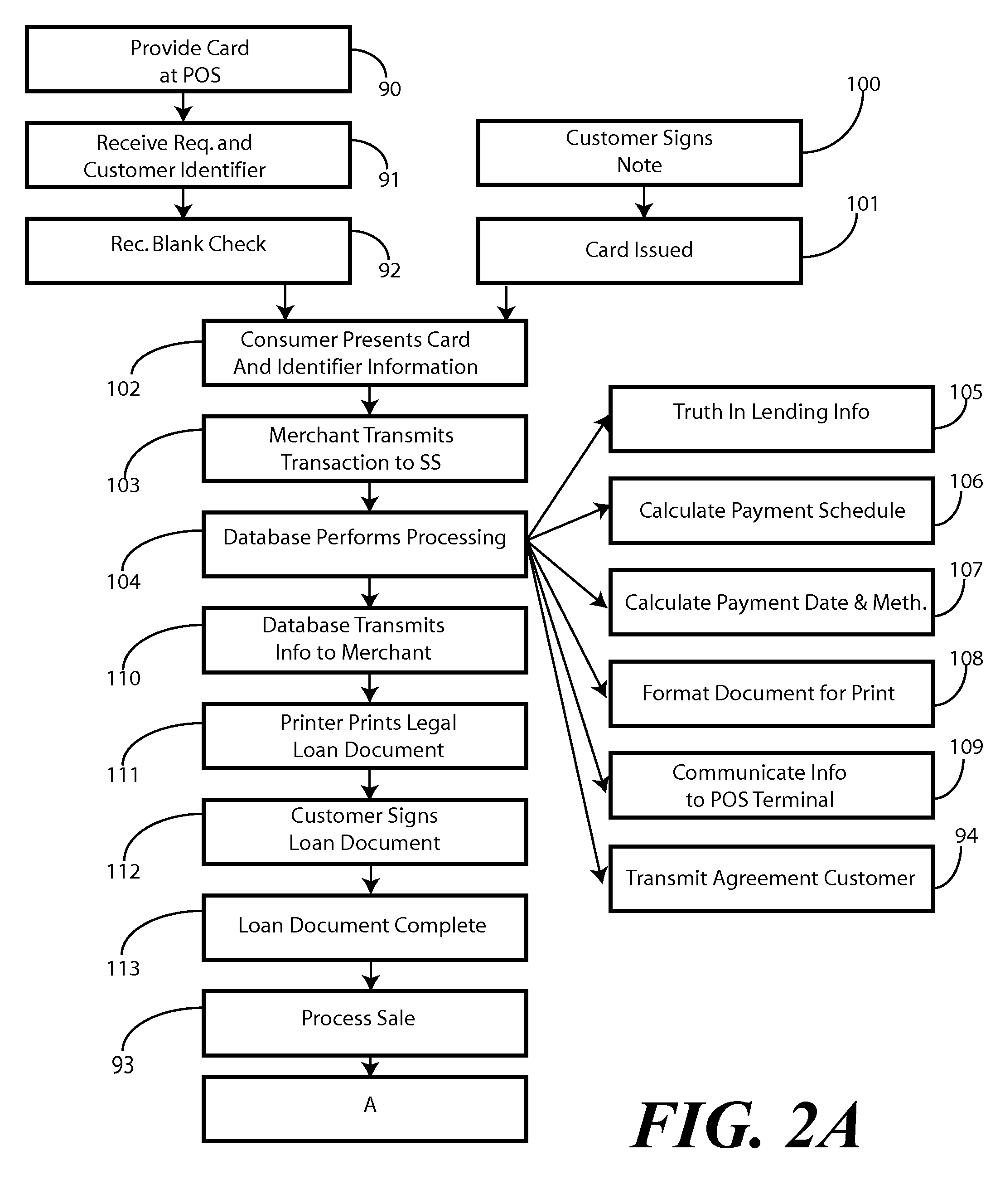

Point of Sale Credit System

A method and system for providing credit at a point of sale are provided. The method includes both an open-ended model and a closed-ended model. In the open-ended model a card, such as a credit card, is provided to the customer. The customer first enters into an agreement for repayment with a credit provider. When the customer uses the card, a new installment transaction is added to a revolving line of credit. An open-ended loan agreement is delivered to the customer at the point of sale. The open-ended loan agreement may include available credit left, payment terms, and payment date. In the closed-ended model, the customer need not first sign an agreement with the credit provider. The customer simply obtains and uses a card to obtain a closed-ended, single installment, installment loan.

Owner:CCIP

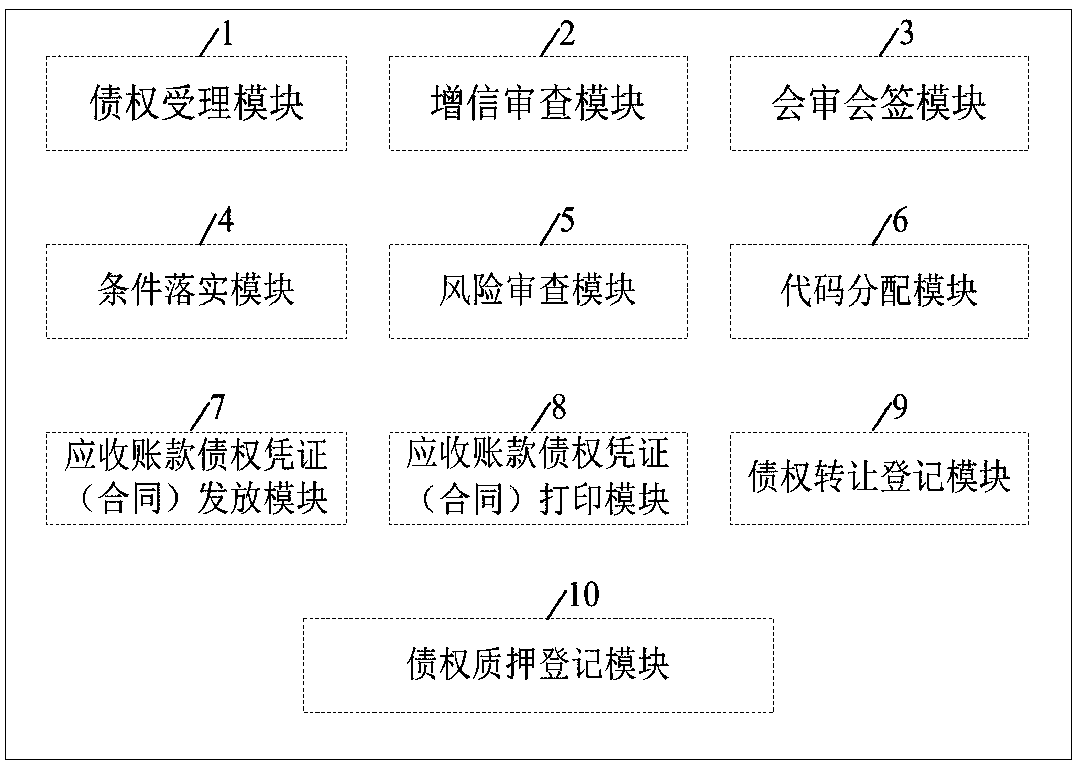

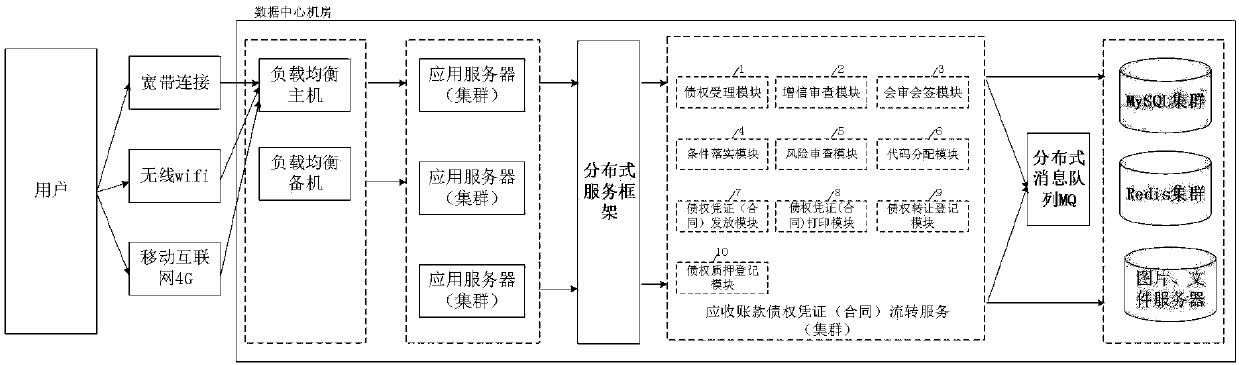

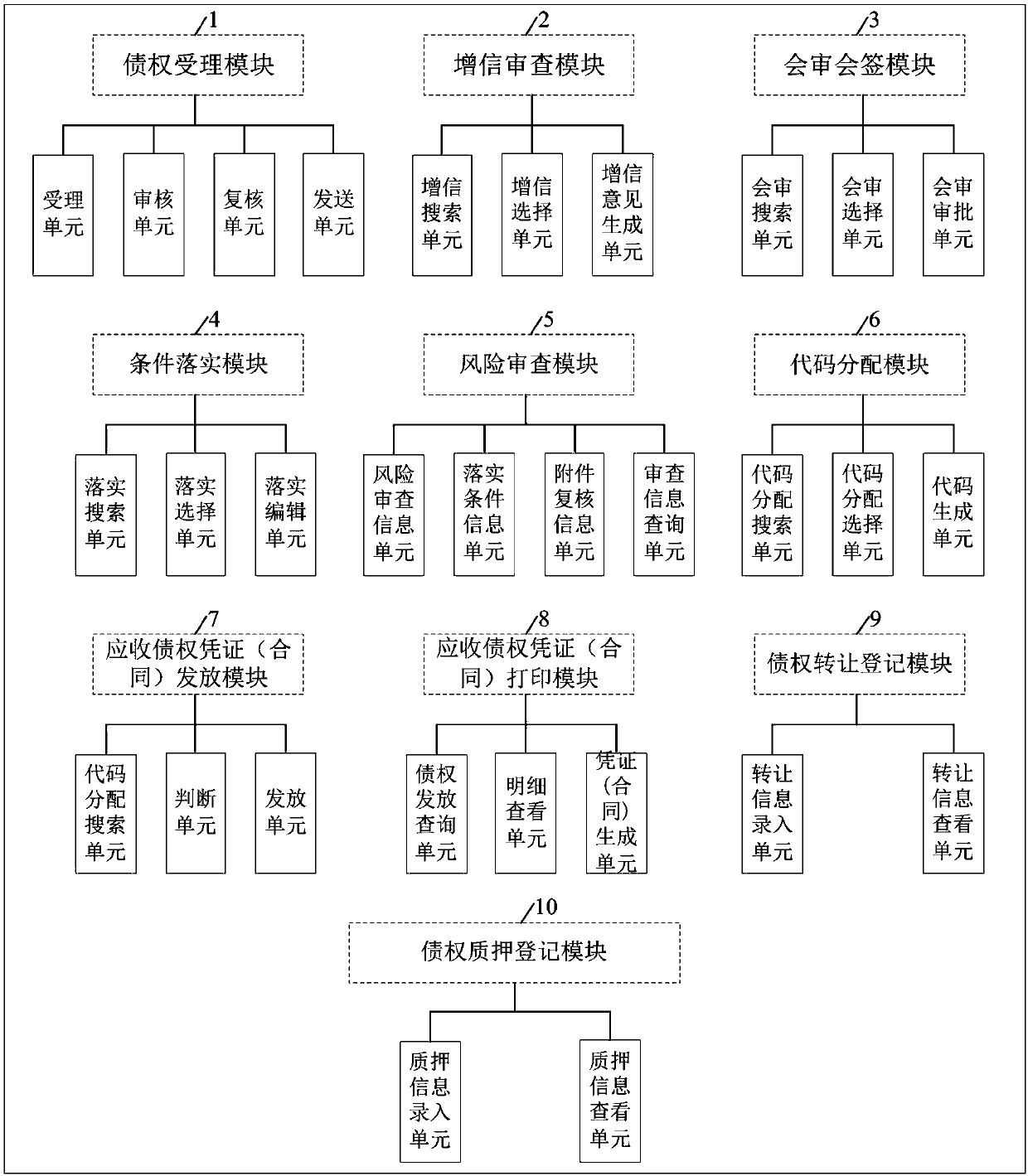

Account receivable creditor's rights certificate (contract) transfer system

ActiveCN108038781AEffectively resolve debtDiversified solutions to social conflicts and disputesFinanceCredit systemMedium enterprises

The invention discloses an account receivable creditor's right certificate (contract) transfer system and method. The system comprises a creditor's right acceptance module, a risk review module, a code distribution module, an account receivable creditor's right certificate (contract) issuing module, an account receivable creditor's right certificate (contract) printing module, a creditor's right assignment module and a pledge registration module. Through sciences and technologies and a credit enhancement manner, account receivables, in static state, among various economic subjects are converted into paper or electronic account receivable certificates (contracts) which integrates the functions of financing, commodity financing, transfer, transaction and refunding (countervailing); in practice, solely state-owned account receivable creditor's right management companies are established by local governments or group applications are organized via mediation such as people mediation, industrial mediation and commerce chamber mediation; and through the system, account receivable creditor's right certificate (contract)s are issued for account receivables which accords with conditions so asto carry out transfer, so that a positive role is played in solving difficult financing of small and medium enterprises, resolving chain debts, resolving the debts of local governments and pushing the construction of credit systems.

Owner:安徽海汇金融投资集团有限公司 +1

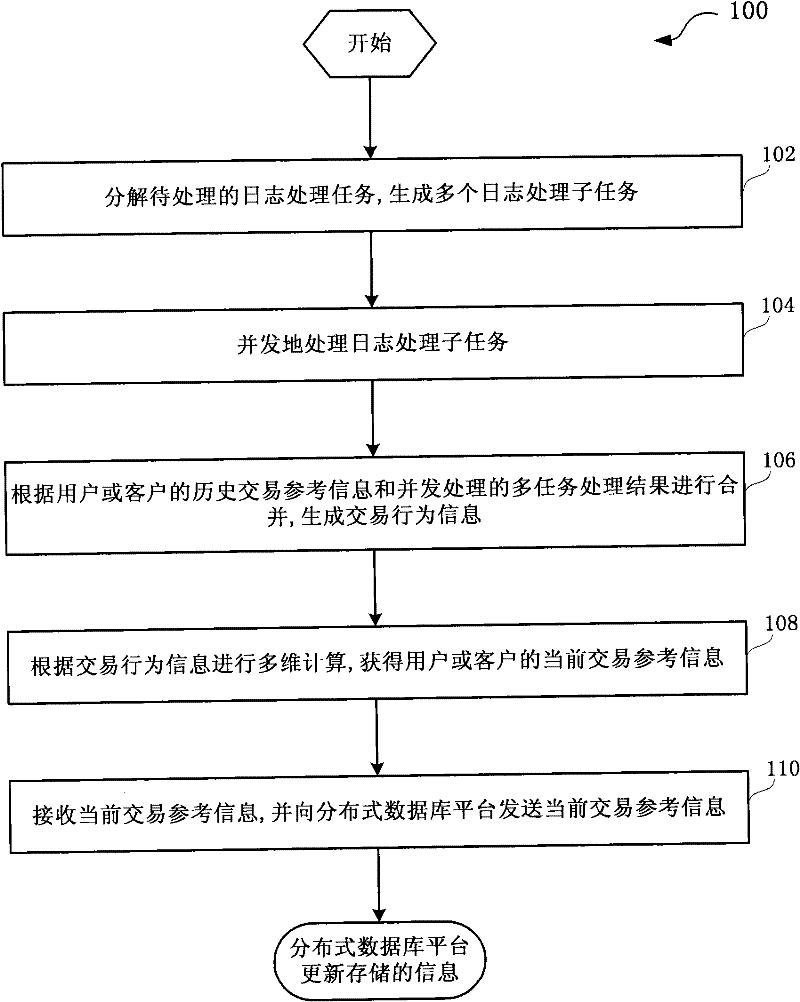

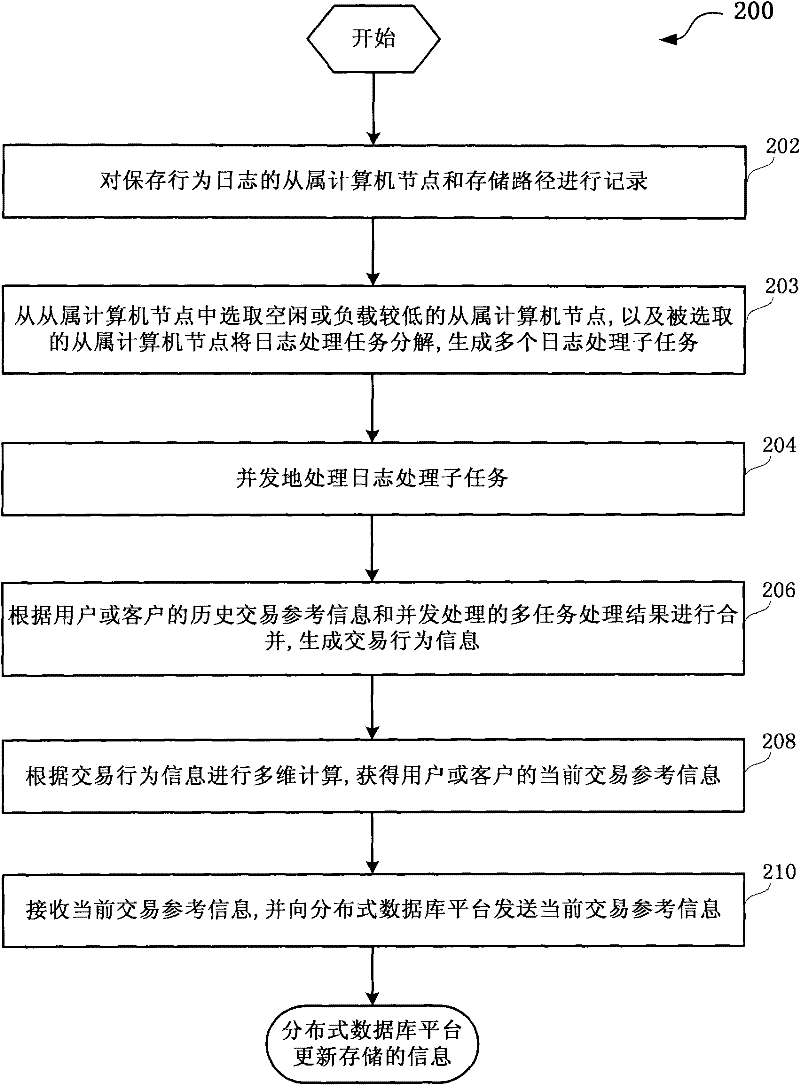

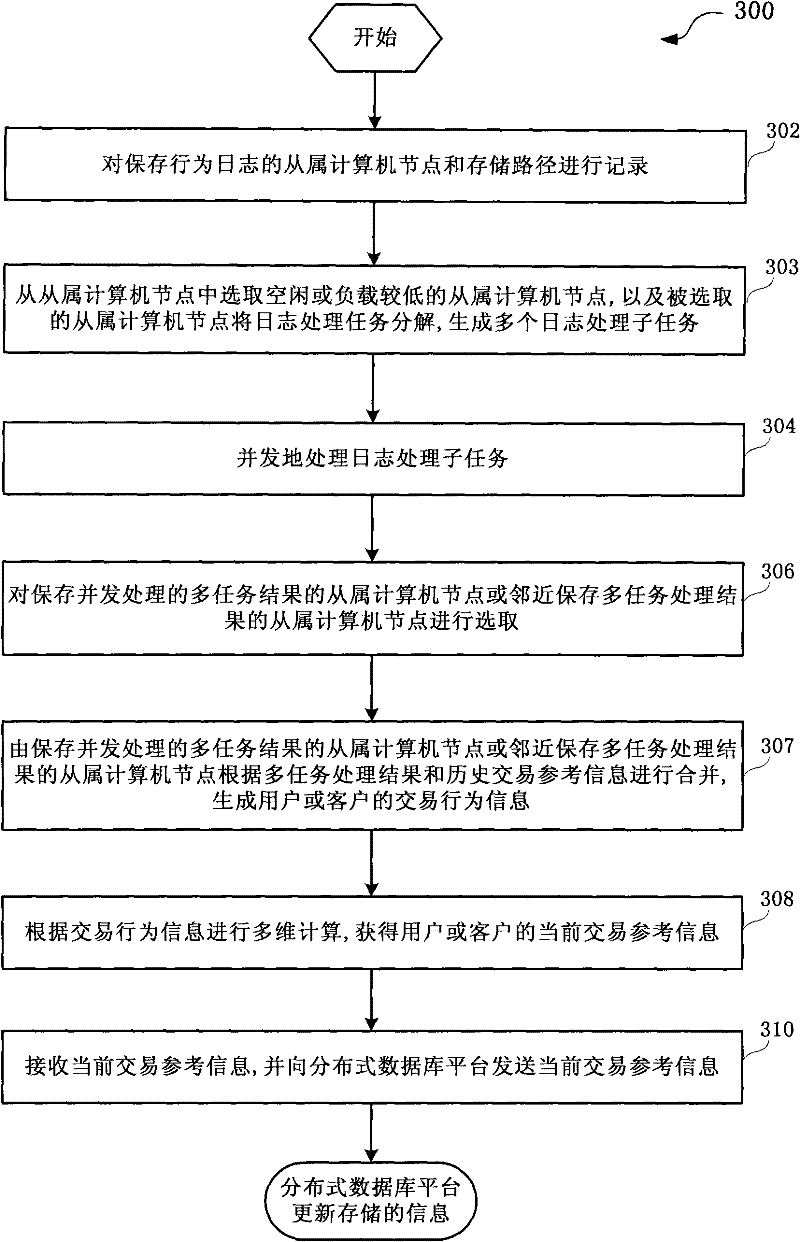

Real-time computation method and system of multi-dimensional credit system based on user empowerment

ActiveCN102236851AStrong scalabilityAddressing Mass SurgesCommerceSpecial data processing applicationsCredit systemMulti dimensional

This invention discloses a real-time computation method and system of a multi-dimensional credit system based on user empowerment. The method comprises the steps of: decomposing a to-be-processed log processing task to generate a plurality of log processing sub-tasks; concurrently processing the log processing sub-tasks, merging according to historical transaction reference information of a user or a client and a multi-task processing result obtained by concurrent processing to generate transaction behavior information; according to the transaction behavior information, performing multi-dimensional computation to obtain the current transaction reference information of the user or the client; and receiving and sending the current transaction reference information to a distributed database platform. The method of the invention solves the technical problem of unavailable real-time transaction reference information caused by massive and sharp increase of transaction platform log data and mining of multi-dimensional information at present, thus being favorable for providing users with more accurate and credible transaction reference information.

Owner:BAIDU ONLINE NETWORK TECH (BEIJIBG) CO LTD

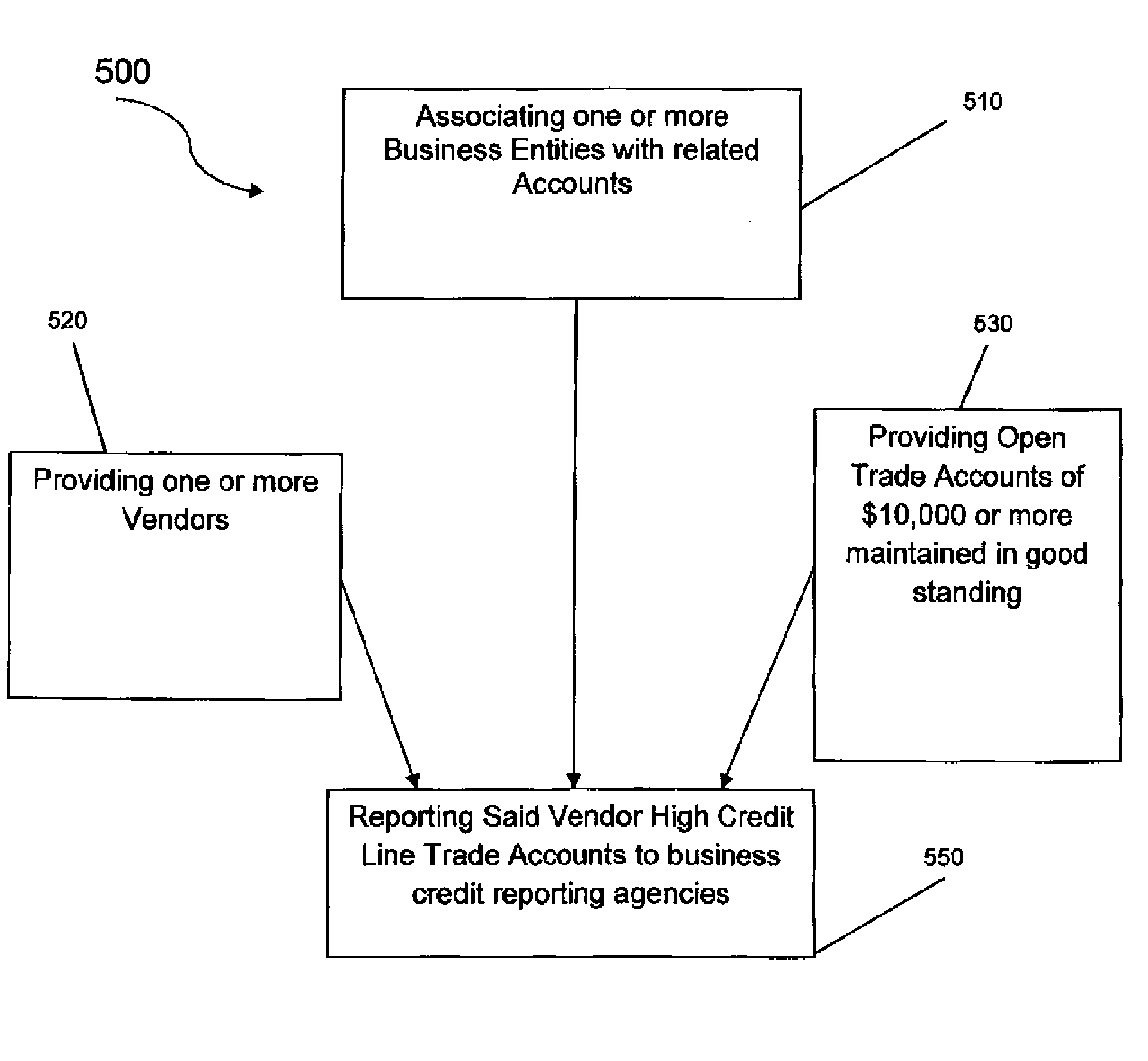

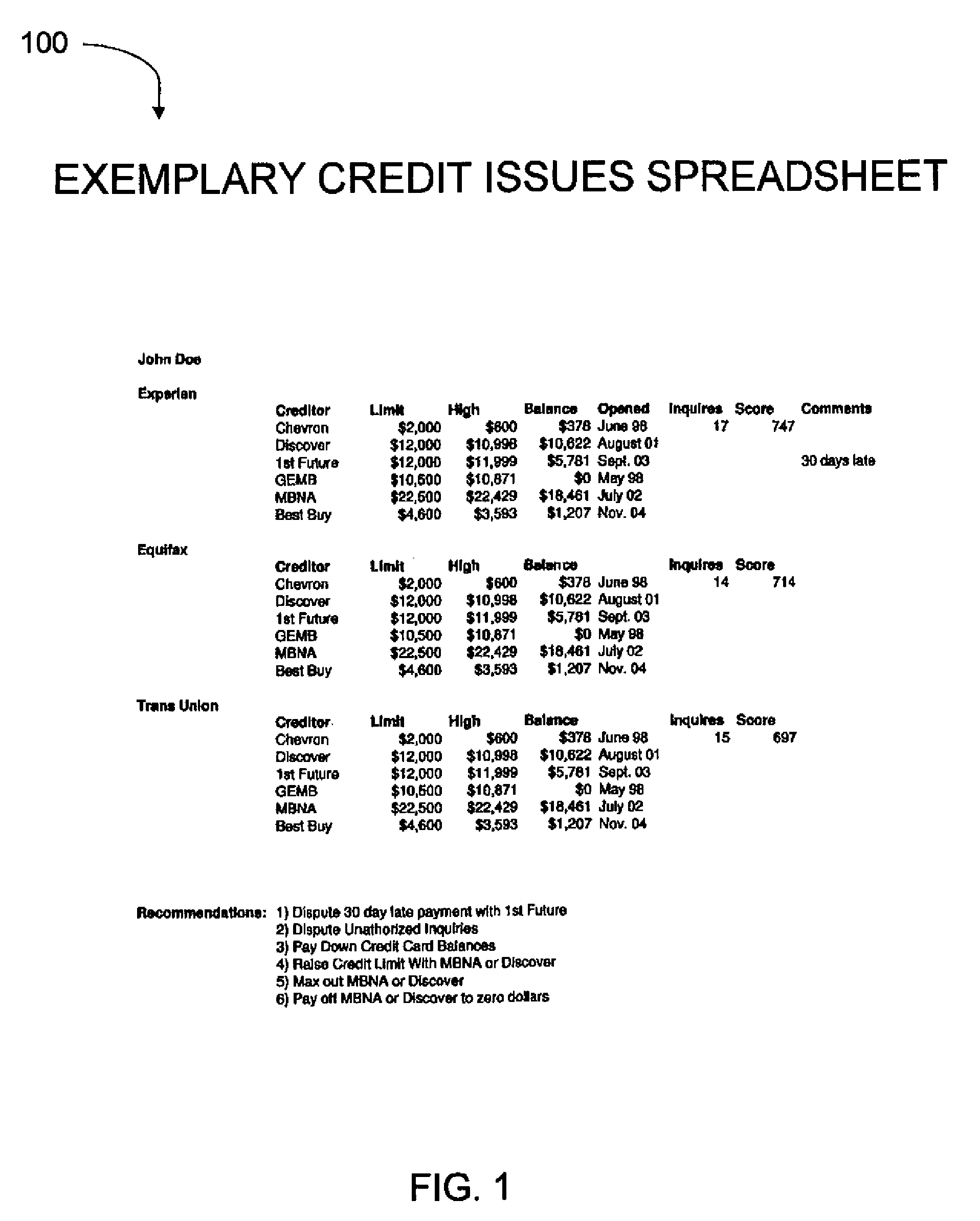

Systems and methods for establishing business credit and improving personal credit

InactiveUS20080294547A1Increasing credit scoreMaximizes positive impactFinancePayment architectureCredit systemExternal data

Systems and methods are disclosed for establishing one or more personal guarantor(s); establishing one or more business entities; establishing a professional business presence; reporting the professional business presence and the one or more personal guarantors to one or more credit scoring companies; establishing a PAYDEX score of said one or more business entities to a minimum of 80 resulting in an applicant's ability to obtain a larger credit line and at more favorable contract terms determined by one or more credit line providers reviewing external data. Another embodiment includes a method for establishing at least one high credit line credit accounts of one or more business entities with an open trade account of $10,000 or higher maintained in good standing and reporting said trade accounts(s) to the business credit scoring agencies.

Owner:ZIGMAN JEREMY

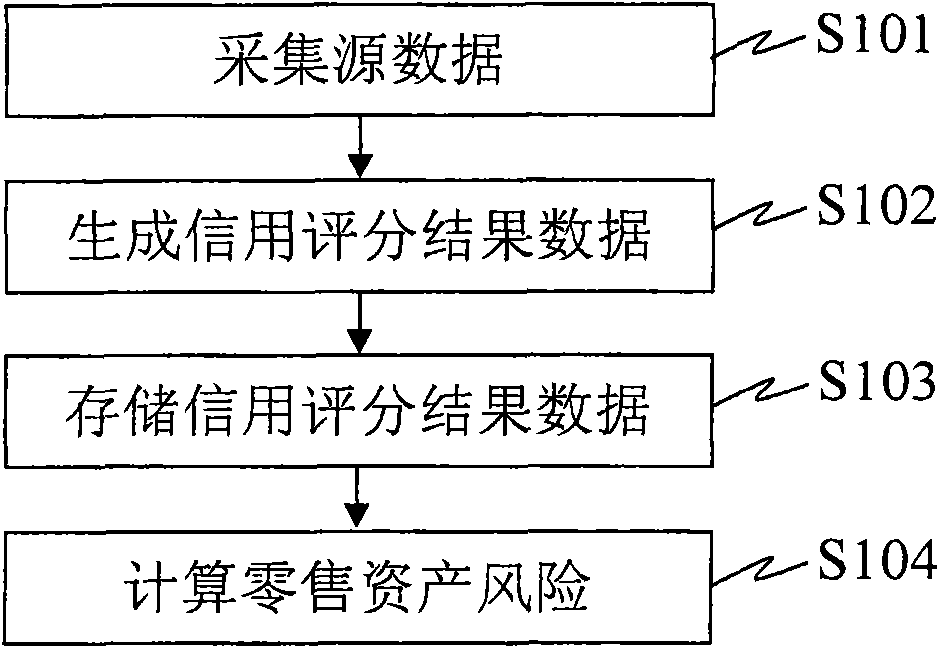

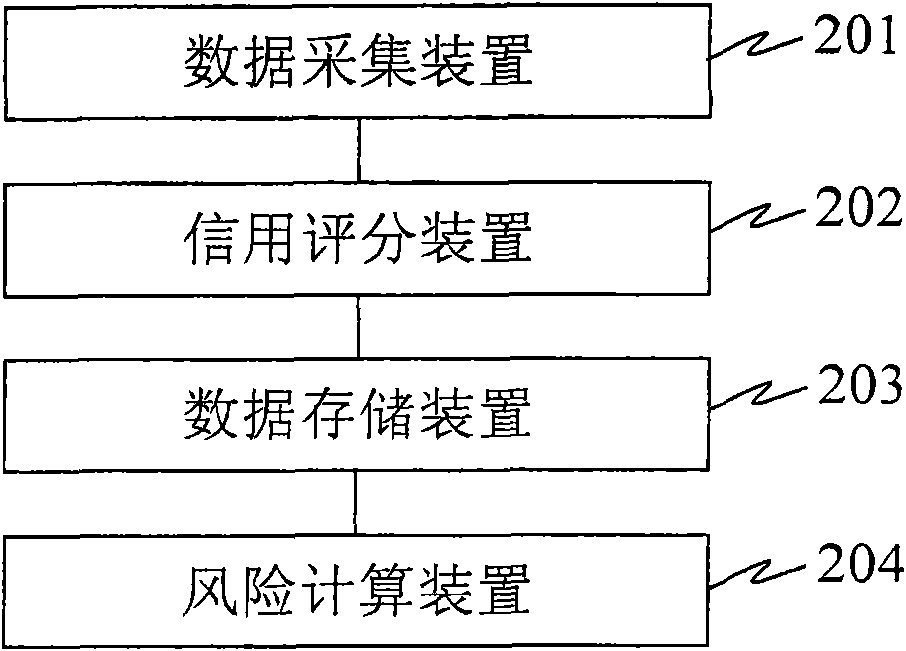

Method and system for calculating retail asset risk

The invention provides a method and system for calculating retail asset risk. The method comprises the following steps of: collecting source data, wherein the source data comprises loan and credit card transaction data and customer asset data collected from each business system of a bank, customer and account data collected from a personal credit system and a bank card system in real time during application and customer credit information data collected from a personal credit information system in real time during application; receiving the source data, and performing credit scoring and credit rating to generate credit scoring result data; storing the credit scoring result data into a data storage device for a user to invoke; and invoking the credit scoring result data to calculate the retail asset risk according to a preset rule. The method and the system can be used for controlling the retail asset risk of the bank, can greatly reduce the dependence of bank credit personnel on the assessment criteria not objective and stable enough in the credit business, can effectively reduce randomness in decision and can reduce manual operation cost.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

Establishing method of electronic wallet based on block chain

InactiveCN107369010ASolve the ceiling problemResolve trust issuesPayment protocolsPayment circuitsCredit systemValue passing

The invention discloses an establishing method of an electronic wallet based on a block chain. The method comprises steps of 1) establishing a new transaction and issuing various types of assets; 2) carrying out the transaction and broadcasting transaction lists to the whole network through a P2 network; 3) carrying out transaction verification; 4) verifying results and broadcasting transaction results to the whole network after the transaction is finished; and 5) writing the transaction results into a block of a block chain. According to the invention, by use of the distributed account book technology, the digital asset flows and real cash payment on the block chain are connected, so in the global Internet market, the function of high-efficiency and low cost value delivery that the traditional financial mechanism cannot replace can be developed; a block chain credit system from the information to the value network is formed; the cryptography packet of each person can be developed into a 'self-finance' platform; and payment, depositing, transferring, exchange, loans and the bookkeeping and clearing in the whole network of the P2P can be achieved.

Owner:兰考同心互联数据管理有限公司

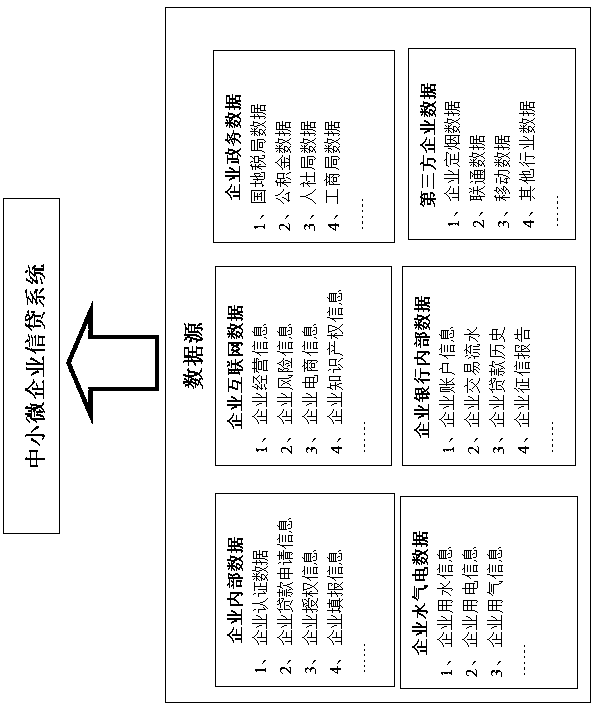

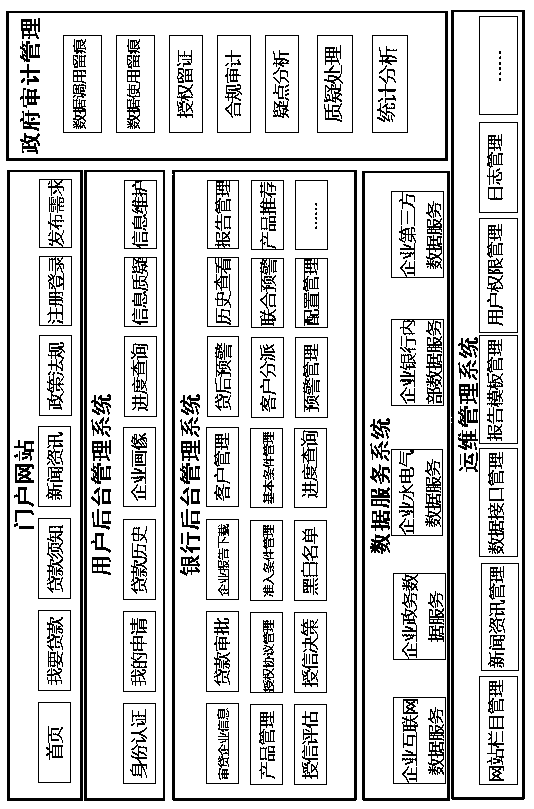

Medium small and micro-sized enterprise credit system

InactiveCN108876134AIncrease innovationImprove efficiencyFinanceOffice automationInformation processingCredit system

The invention provides a medium small and micro-sized enterprise credit system, and belongs to the technical field of information processing. According to the system, based on enterprise (personal) authorization, according to enterprise internet big data, government affair data, enterprise internal data, water electricity and gas data, bank data and third-party data, the data are connected, integrated and analyzed; a small and micro-sized enterprise credit model is built; rapid evaluation of enterprise credit is achieved; enterprise comprehensive credit is evaluated through the enterprise credit model; a bank performs credit granting evaluation on medium and small-sized enterprises in combination with credit granting evaluation and credit granting decision models through an enterprise comprehensive credit model, and notifies evaluation results to the enterprises for performing offline lending; one-stop financial services are provided for the enterprises; and online client acquisition and comprehensive risk control services are provided for the bank. The problems of difficult financing, expensive financing and low financing efficiency of the medium and small-sized enterprises are solved; fast, efficient and authoritative enterprise comprehensive credit evaluation scores are provided for financial credit agencies; and integrity development of the enterprises is promoted.

Owner:浪潮卓数大数据产业发展有限公司

System and method for electronic fund transfers for use with gaming systems

ActiveUS8715066B2Low costFinanceApparatus for meter-controlled dispensingCredit systemNetwork connection

An electronic fund transfer (EFT) system for managing and transferring electronic funds from a user's financial account to a credit system includes a credit system configured to dispense credit to a user via physical or electronic credit means, an electronic fund transfer (EFT) device, a secure payment gateway configured to connect to the user's financial accounts via a financial asynchronous transfer mode (ATM) network, a host system connected to the credit system via a local network, a funds management portal connected to the host system and the secure payment gateway, and means for transferring electronic funds from the user's financial account to the credit system via the secure payment gateway. The funds management portal accounts and reconciles the transferred electronic funds. All communications between the secure payment gateway and the host system pass through the funds management portal. The EFT device includes a secure client-side application for receiving instructions from the user for transferring electronic funds from the user's financial account to the credit system and means for transmitting the fund transfer instructions to the user's financial account. The EFT device is configured to connect to the secure payment gateway and to communicate with the user's financial account and to transmit the instructions for transferring electronic funds from the user's financial account to the credit system via the secure payment gateway.

Owner:AUTOMATED CASHLESS SYST INC

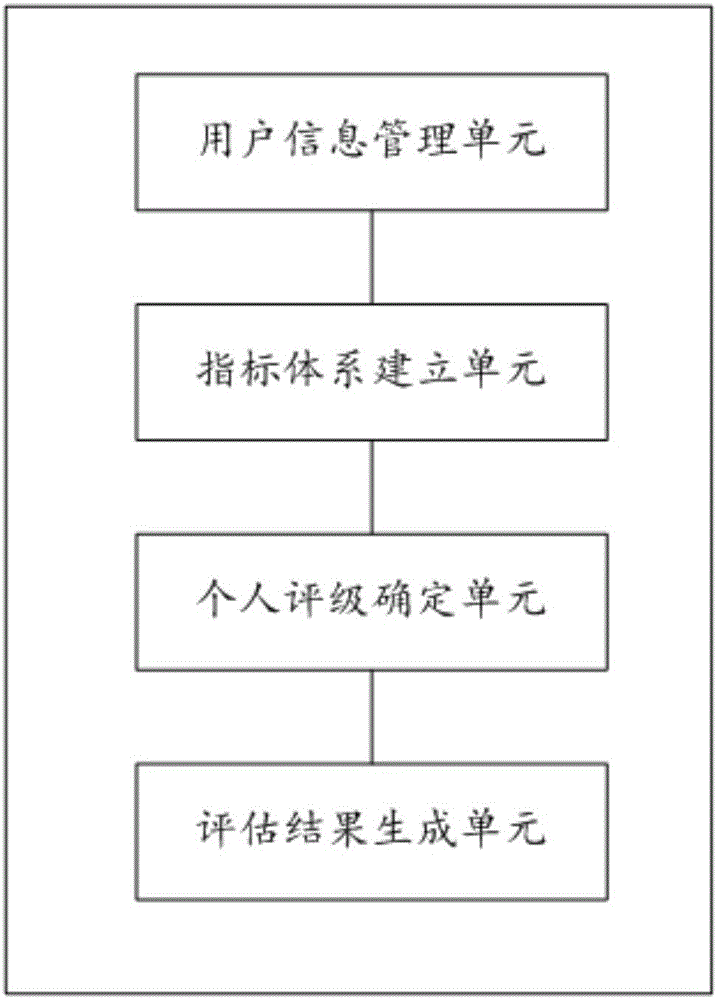

Bank risk evaluation system based on user behavior

A bank risk evaluation system based on user behavior comprises the following units: a user information management unit, which is used to obtain the users' basic information, value system situation, credit system situation and account situation; an index system establishing unit, which is used to establish related relationship matrixes of the basic information, value system situation, credit system situation, and account situation, set characteristic vector values and single ordering consistency checking values of each related relationship matrix, and obtain a marking index system of user behavior; an individual rating determining unit, which is used to carry out weighting calculation on secondary indexes in the marking index system to obtain the membership functions of each secondary index and judge the individual rating situation of a user according to each membership function; and an evaluation result generating unit, which is used to obtain the evaluation result of bank risk based on the input individual rating situation of all users through a BP neuro-network algorithm.

Owner:WUHAN TIPDM INTELLIGENT TECH

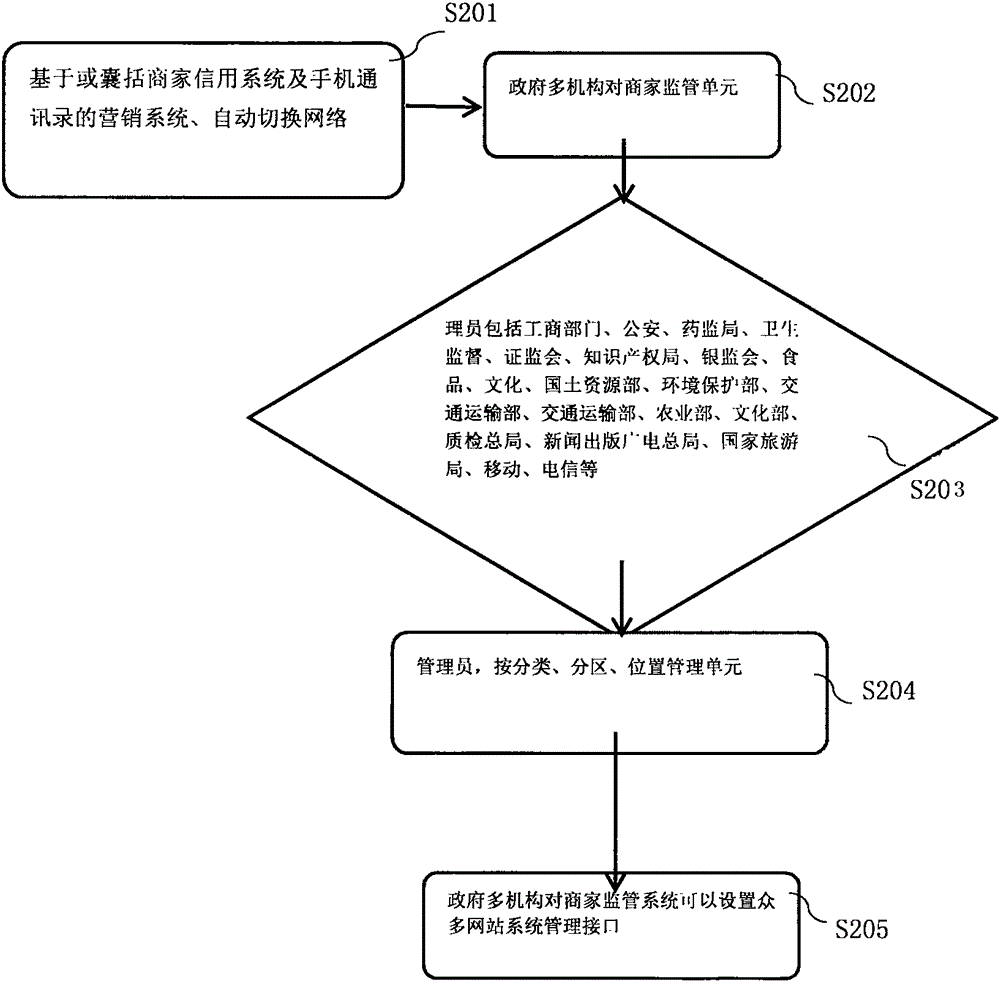

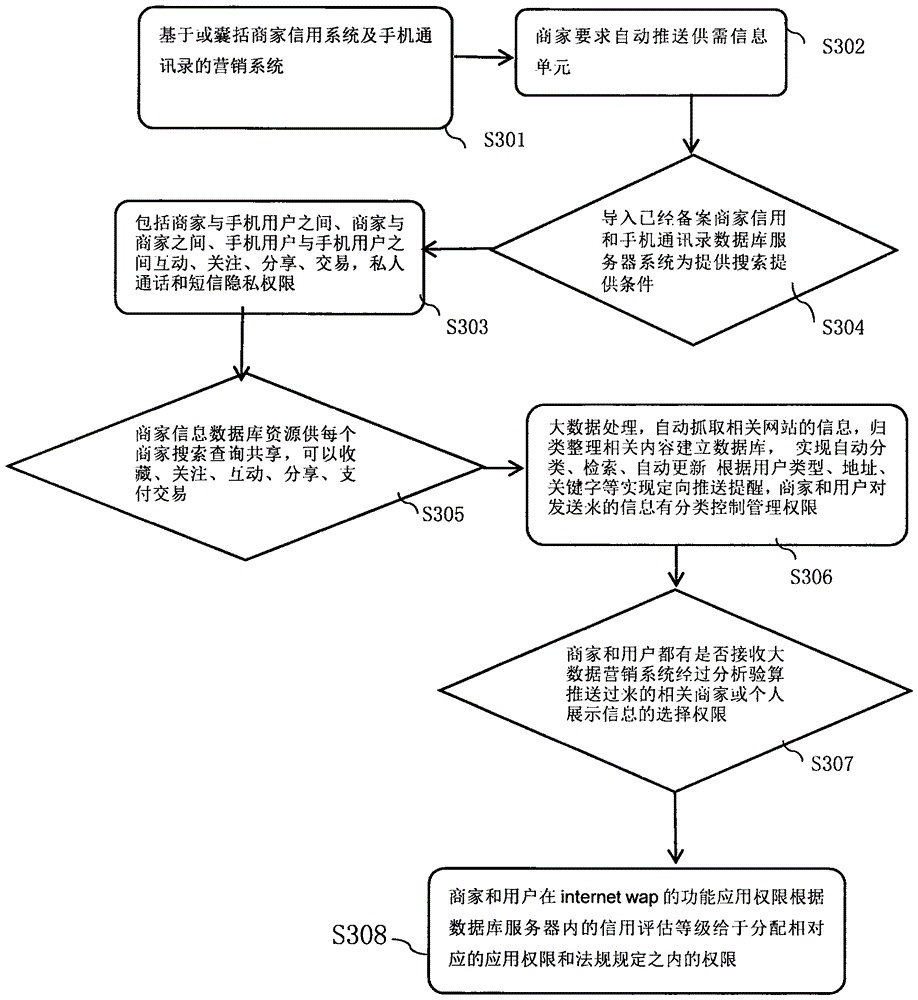

Marketing system based on or including shopper credit system and cellphone contact list

The invention discloses a marketing system based on or including a shopper credit system and a cellphone contact list, and belongs to an e-commerce and certification system. By automatically switching network, a shopper registers to set up a shop in the system, fills a domain name network name, qualification, business scope, patent copyright, advertisement and credit information. The information is compared with information imported in a shopper database server to verify the information. Related supervision mechanisms are set to carry out partition, classification, positioning and searching. Information required by the shopper is automatically captured and pushed though big data. A cellphone number user in the system directly logs in to compare and verify existed information fed back by the database server and data sharing of the user and the shopper. The user and the shopper have their own server units. Voice, video, image, text and information receiving and sending management are carried out among users. According to classification of industrial regulations, private conversations, retrieval is carried out on commerce and social communications, real names, virtual names, cellphone numbers and basic information and hidden retrieval setting management is opened. Phone books and group chats are established and managed as required according to classification of private conversations, commerce and social communications.

Owner:石平安

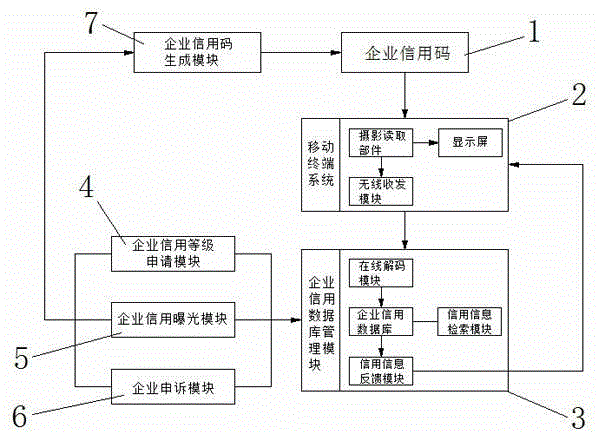

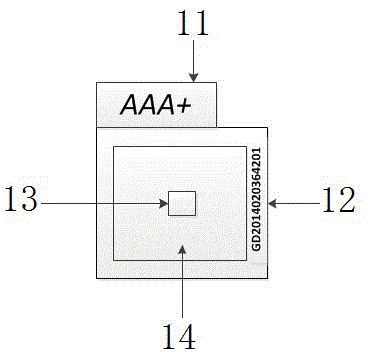

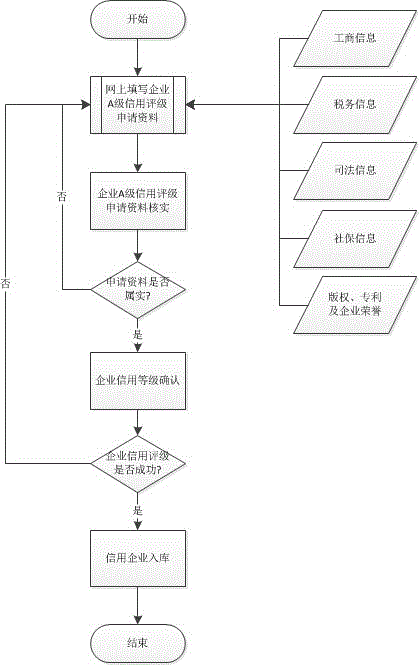

Enterprise credit website system

InactiveCN104573937AEliminate cognitive limitationsAvoid postingFinanceResourcesCredit systemKnowledge management

The invention discloses an enterprise credit website system for identifying the business condition and the credit condition of an enterprise. The enterprise credit website system comprises an enterprise credit code, a mobile terminal system, an enterprise credit database management module, an enterprise credit rating application module, an enterprise credit exposure module, an enterprise complaining module and an enterprise credit code generating module. A mechanism for checking business information of the enterprise is established, and the special enterprise credit code is generated, so that a user can acquire enterprise credit data, including enterprise information, enterprise credit information, the enterprise credit level as well as enterprise promotional images and videos, more conveniently, and audiences can know the credit condition of the enterprise quickly. Besides, feedback information of the government and related management departments is collected, the enterprise credit information is updated, and the enterprise credit system is perfected.

Owner:GUANGZHOU KEYA INFORMATION TECH

Partitioned credit system

InactiveUS20070203853A1Reduce exposureTransaction were limitedComplete banking machinesFinanceCredit systemThe Internet

The present invention discloses a wherein the total available credit for a user is divided into discrete subsets which may be attributed to different purposes such as internet purchases, business transactions, emergency spending, etc., or to different users such as children, travelers, etc.

Owner:GINDI EDDIE

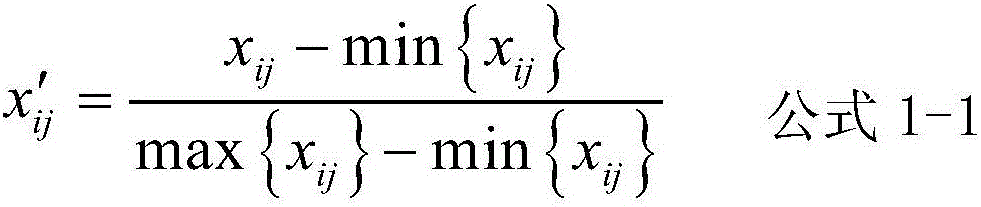

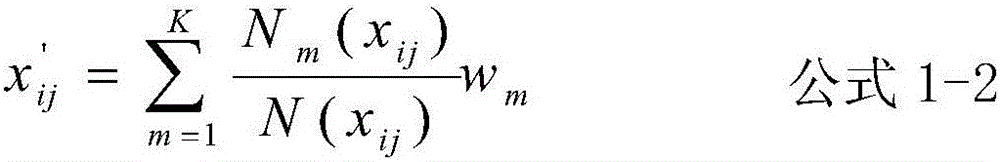

BP neural network credit assessment method based on principal component analysis method

PendingCN106204246AMeet processing needsAvoid subjectivityFinanceBuying/selling/leasing transactionsKernel principal component analysisCredit system

The invention relates to a BP neural network credit assessment method based on a principal component analysis method. According to the BP neural network credit assessment method based on the principal component analysis method, government data related to an individual is combed out of bank data, sample data is formed in combination with a credit assessment result of a bank on the individual, and the prediction performance is improved after the sample data is subjected to unitization processing; dimensionality reduction is carried out on the sample data with the principal component analysis method, complex indexes and multi-dimensional data types can be handled, the demand for processing big data is better met, the credit assessment result of the bank on the individual serves as a reference for training a BP neural network model, and thus a credit assessment model based on government big data is established; the subjectivity of expert scoring can be avoided, credit inquiry can be provided for enterprises or individuals, the credit system of financing institutions is also supplemented, and high classification accuracy and practicability and a good assessment result are achieved.

Owner:YLZ INFORMATION TECH CO LTD

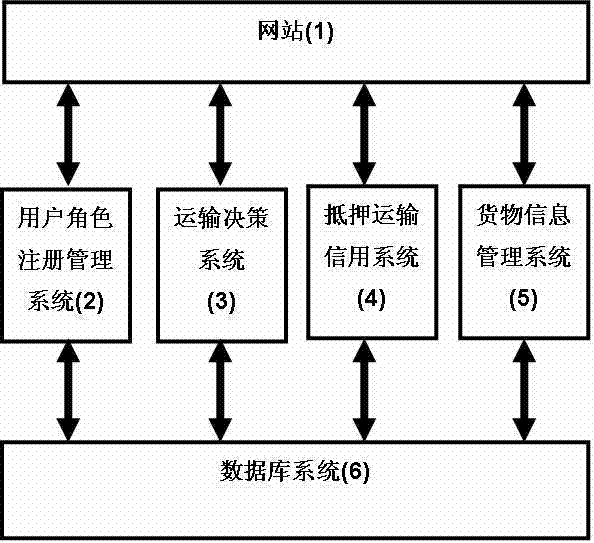

Transporting system and method for express or logistics

The invention discloses a transporting system and a method for an express or logistics, essentially aiming at improving transporting efficiency and service quality of the conventional express or logistics transporting system as well as reducing management cost. With application of a modern computer network technology, an open transporting system organizing method is realized, thereby reducing the management cost of an express enterprise or a logistics enterprise. Through a method for establishing a mortgage transporting credit system, supervision and guarantee of quality safety in a transporting process is achieved with low cost. The method makes it possible to make use of great scattered transport capacity in the society through establishments of the open organizing method and the mortgage transporting credit system, thereby greatly reducing transporting cost of the transporting system.

Owner:刘莎

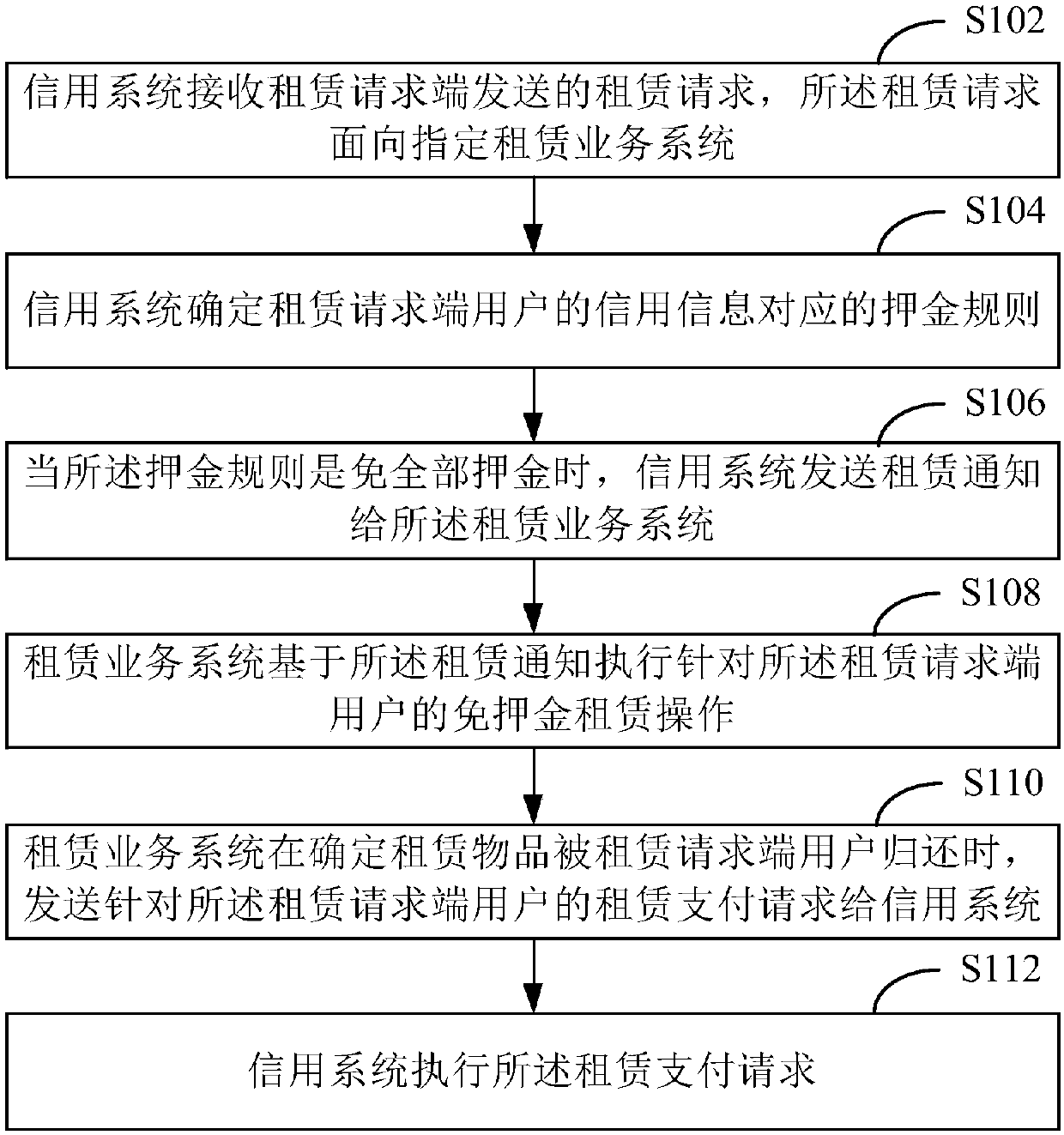

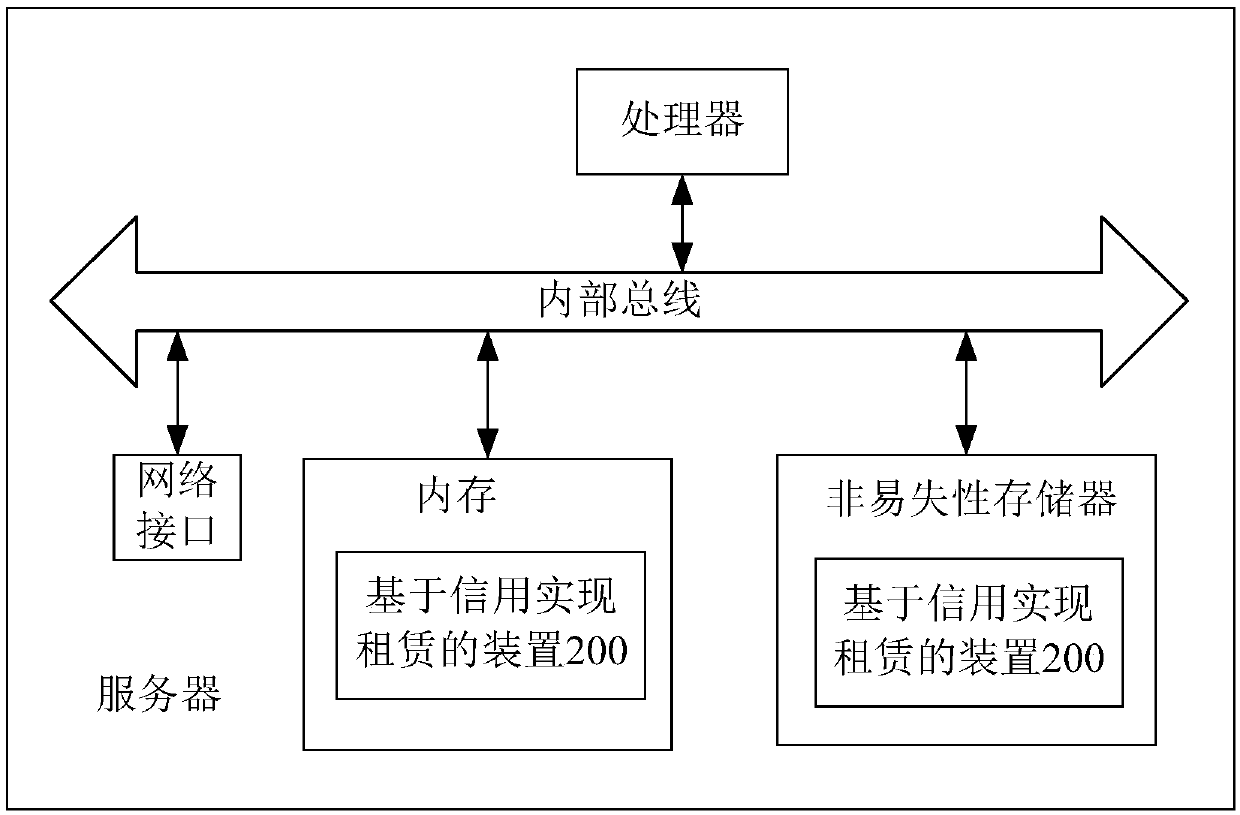

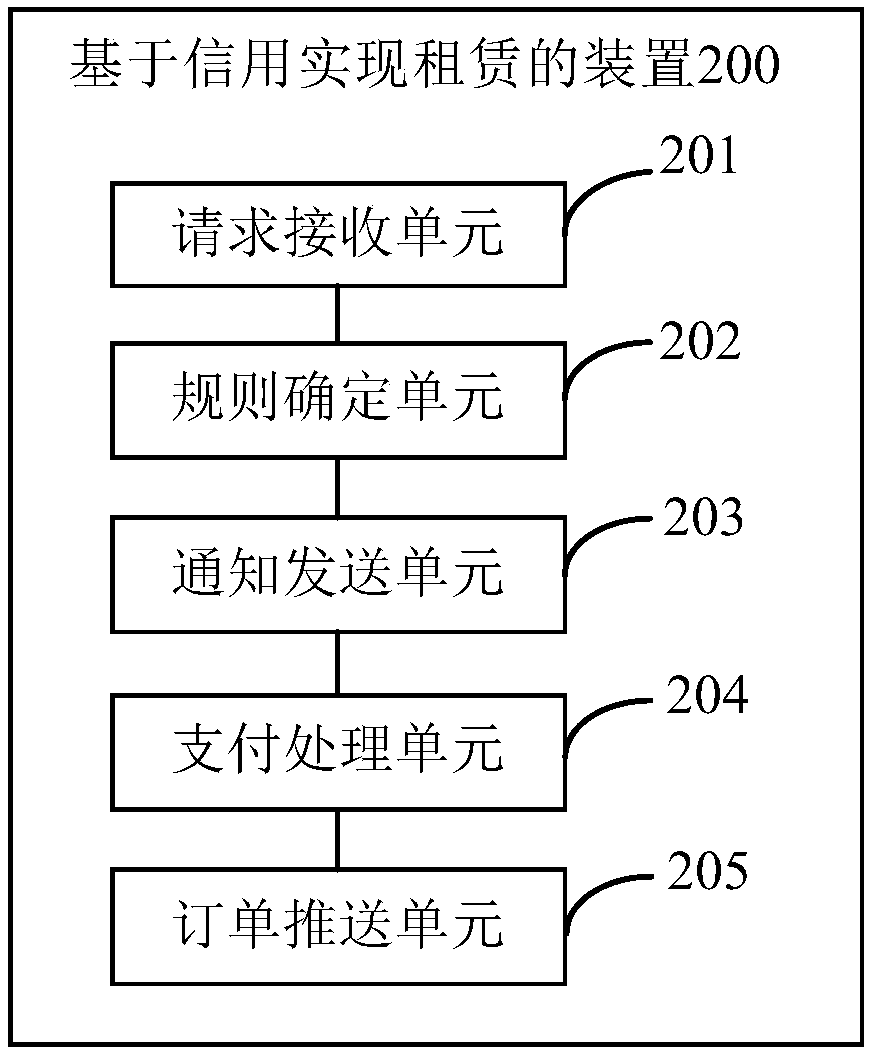

Credit based leasing method

InactiveCN107944970AEasy to implementImprove efficiencyBuying/selling/leasing transactionsService systemCredit system

The invention discloses a credit based leasing method. The method comprises that a credit system receives a leasing request from a leasing request end, and the leasing request faces a specific leasingservice system; the credit system determines a guarantee deposit rule corresponding to credit information of a user of the leasing request end; when all guarantee deposit is exempted from according to the guarantee deposit rule, the credit system sends a leasing notification to the leasing service system; on the basis of the leasing notification, the leasing service system implements a guarantee-deposit-free operation for the user of the leasing request end; when determining that a leased article is returned by the user of the leasing request end, the leasing service system a leasing paymentrequest, aimed at the user of the leasing request end, to the credit system; and the credit system executes the leasing payment request.

Owner:ADVANCED NEW TECH CO LTD

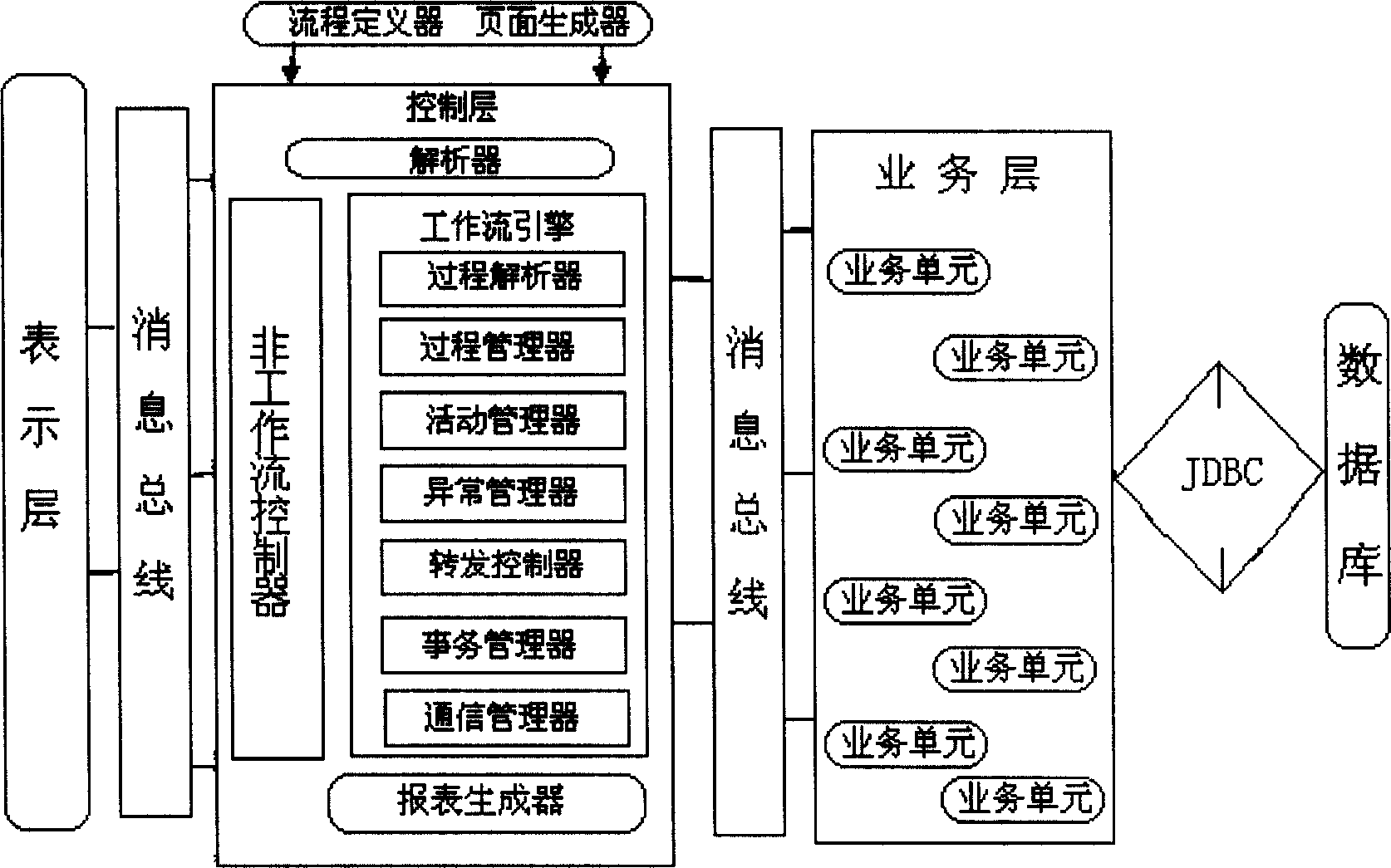

Bank credit operation processing system

InactiveCN101055639ARealize early warning and prediction of credit riskPracticalFinanceCredit systemInformatization

The invention relates to a system for treating the bank credit business, which is designed using integrated application SOA software frame and workflow technology for the characteristic of local country bank; the warning and prediction of the bank credit risk can be provided and carried out through the client credit graded estimation, the loan assessment, the giving credit and the grade classfication of load. The invention has changed the development mode of credit management system based on the flow of 'application-examination and approval-checkup-loan'according to the demand of client in the traditional credit management information treatment. The invention, using SOA configuration, integrates business process and service page, and generate the corresponding credit system, and the recombination of system can be completed in short time. The invention accords with the direction of bank credit management information development. The practicality and comprehensiveness of whole function in the system are strong, reaching domestic leading level in the application aspec of local commercial bank credit business process.

Owner:WUHAN QUNSHENG SCI & TECH

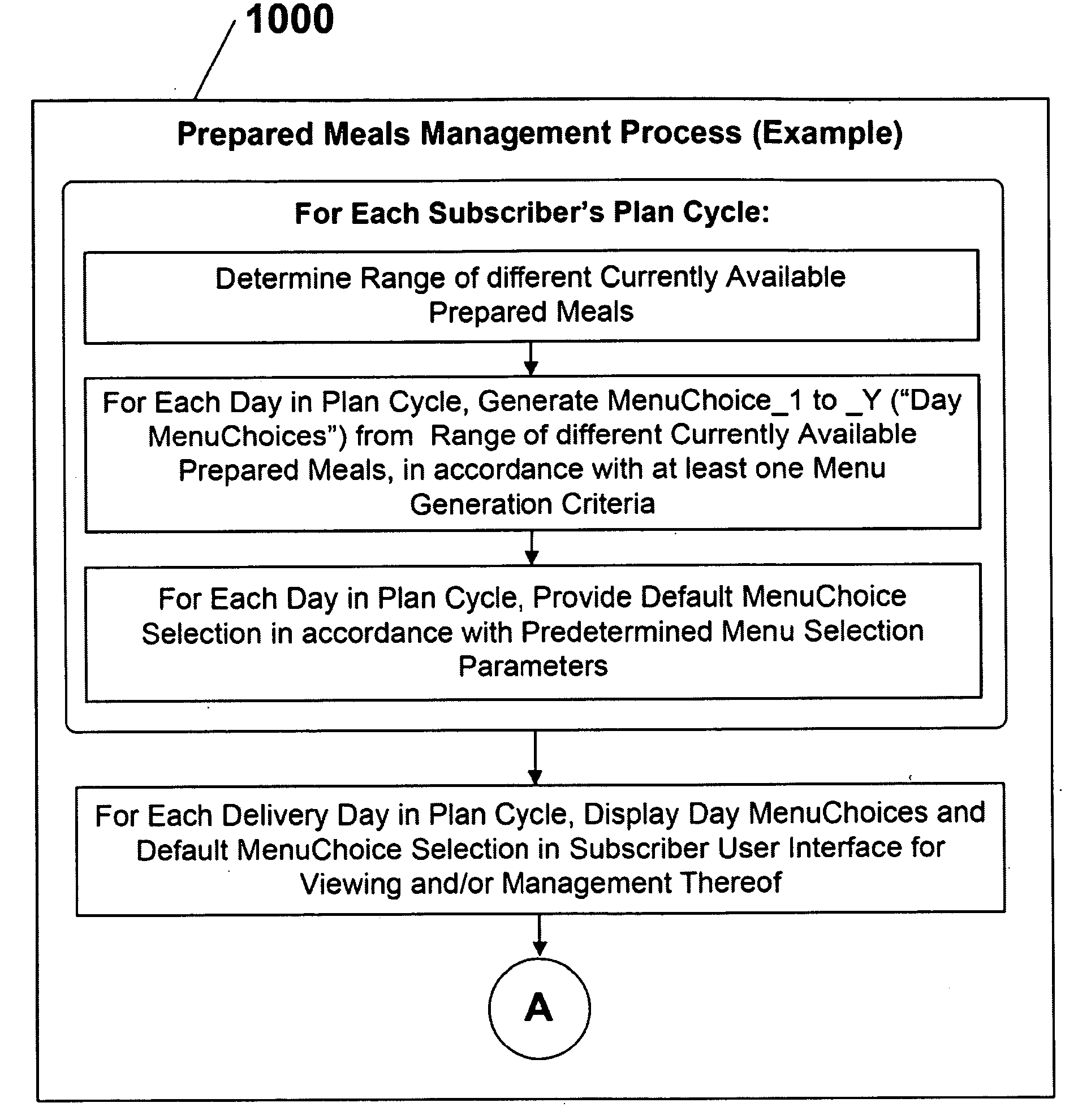

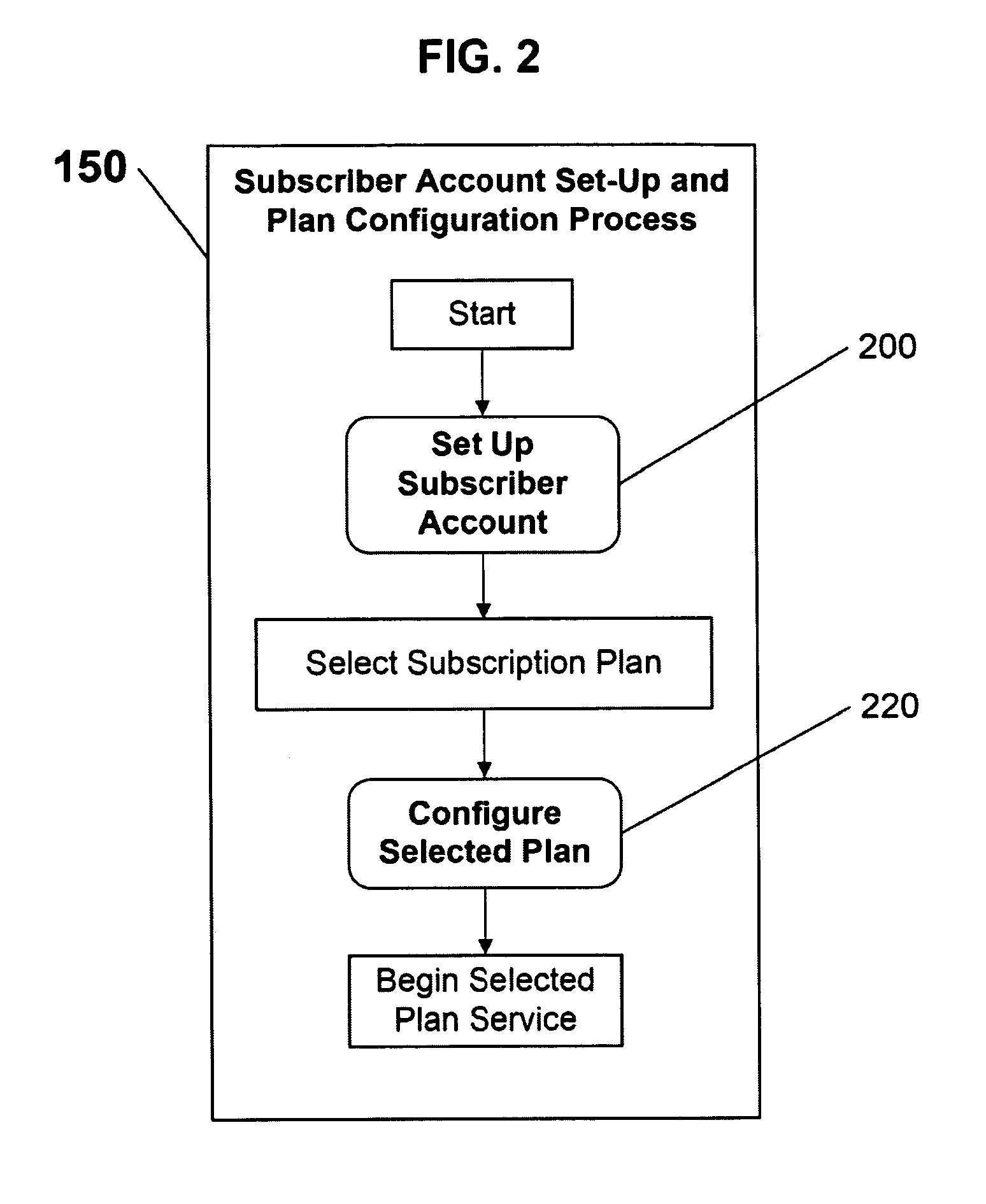

System and method for enabling selective customer participation in dynamically configuring and managing at least a portion of customizable individualized victuals provision services provided thereto

The system and method of the present invention are directed to providing and managing periodic subscription-based victuals preparation and delivery services to customers thereof, while enabling the customers to selectively alter and / or manage pending victuals deliveries, without having to make permanent changes to their subscription plan, and without necessarily sacrificing or decreasing the health, nutrition, and weight-management benefits thereof. In one exemplary embodiment, the inventive system and method transmit notification of pending victuals deliveries to customers with sufficient notice to enable customers to selectively modify and / or cancel all or a portion thereof. The inventive system and method further include an automated credit system for handling full and / or partial meal cancellations.

Owner:NUTRISYST FRESH

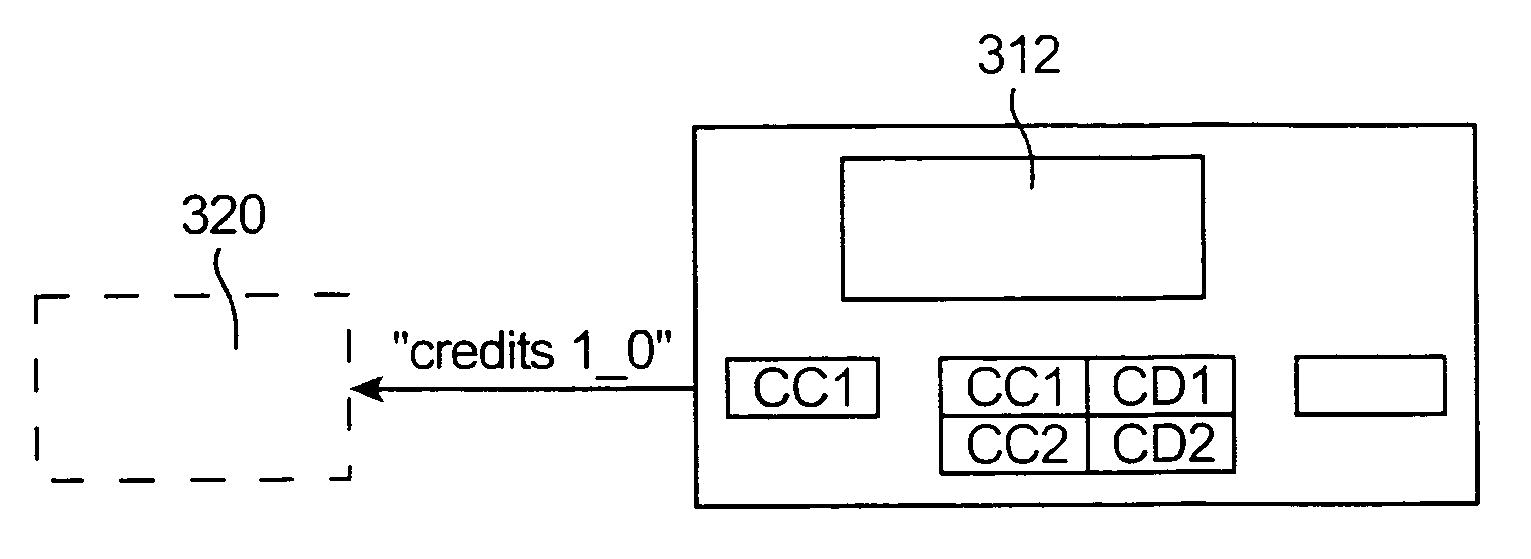

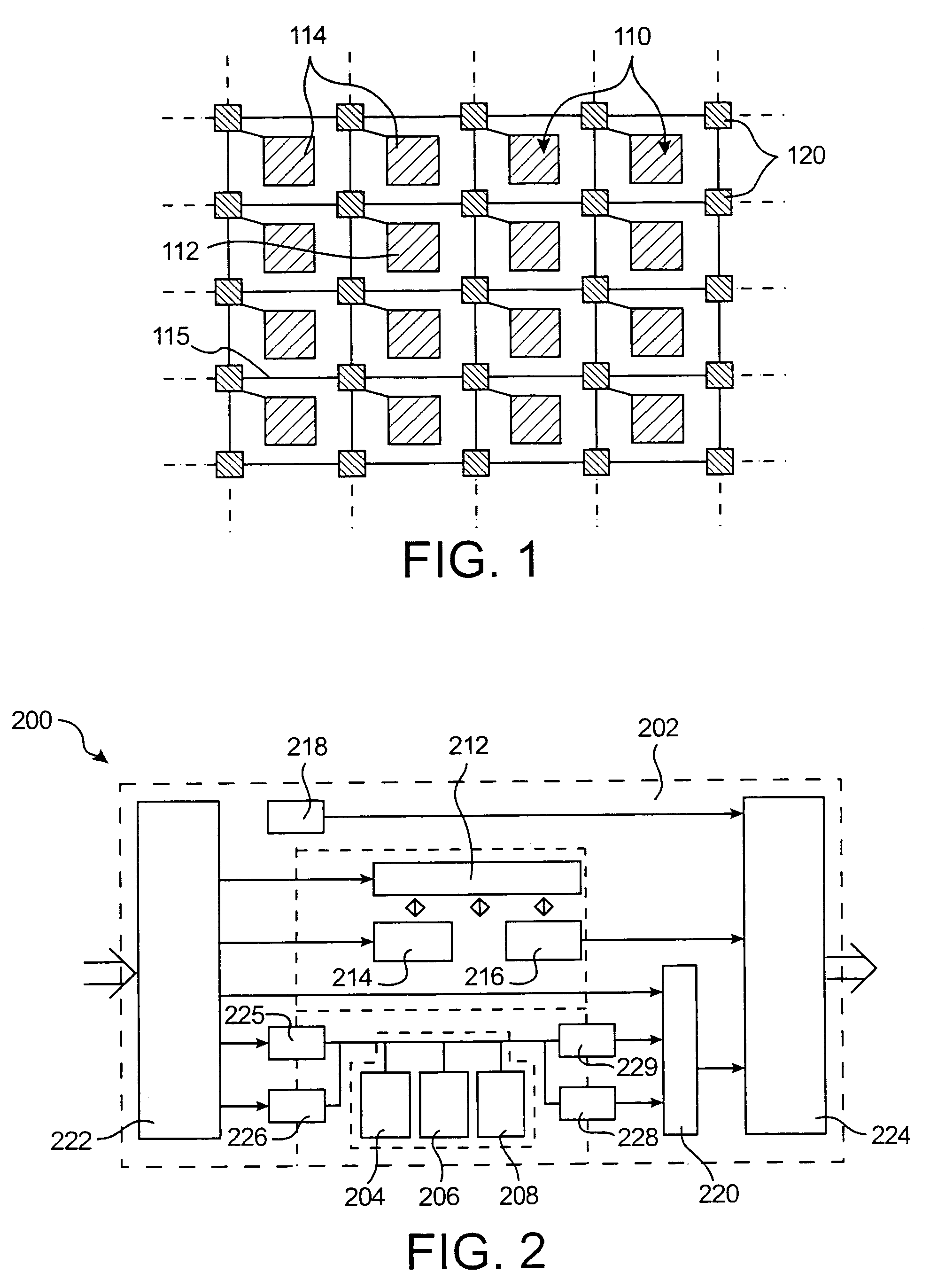

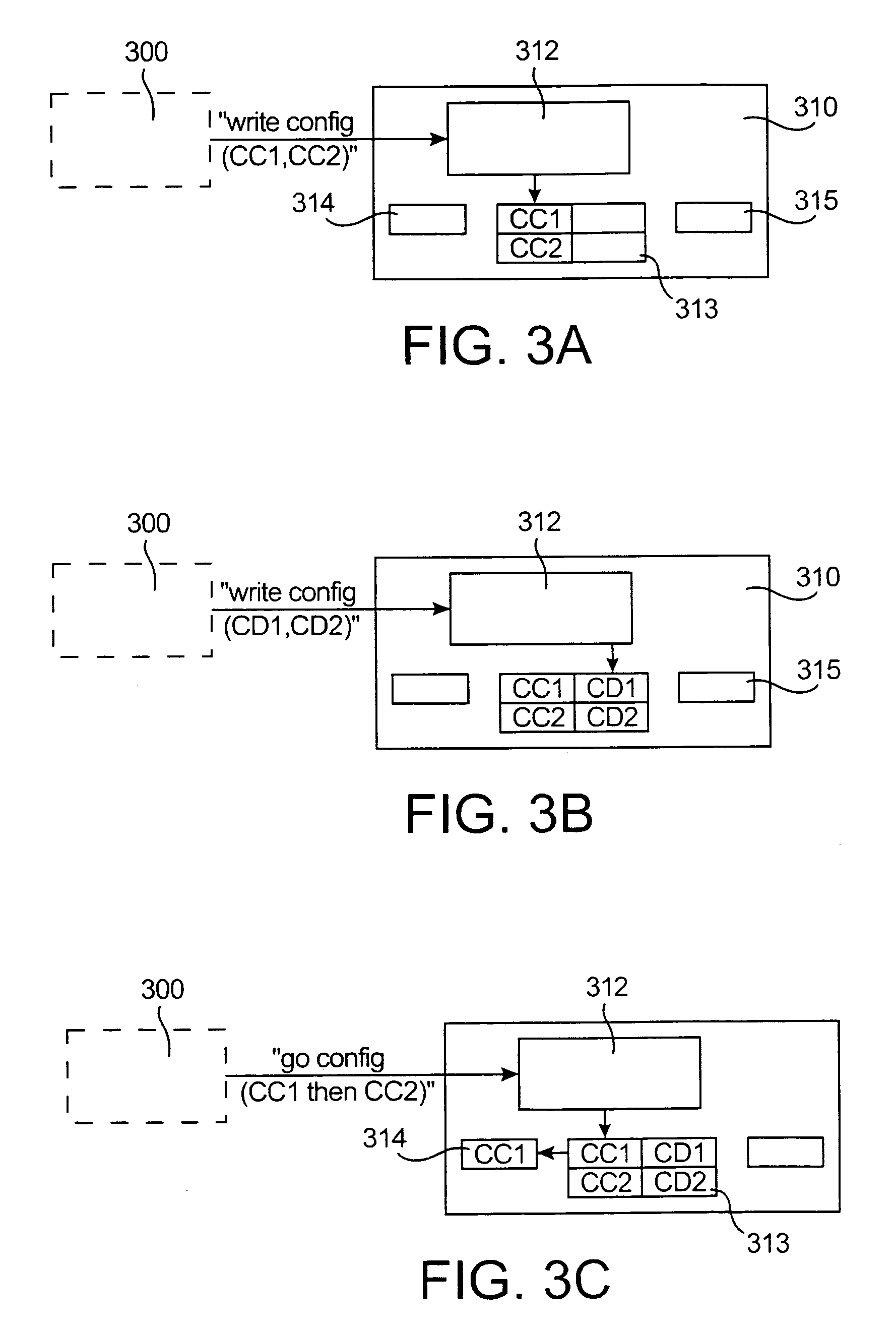

NoC semi-automatic communication architecture for "data flows" applications

ActiveUS20060067218A1Error preventionFrequency-division multiplex detailsCredit systemComputer network

The invention relates to a data processing method in a network on chip formed of a plurality of resources (310,320) capable of communicating with one another and of processing and at least one network controller (300) capable of initialising the communications in the network by initialisation of a credit system, the process comprising at least one communication step between at least one first resource (310) and at least one second resource (320), said communication step comprising: at least one emission by the first resource of a first plurality of special data or “credits” destined for the second resource, at least one receipt by the first resource of a first plurality of data to process sent by the second resource, the emission by the second data resource destined for first resource being authorised following the receipt by the second resource of credits emitted by the first resource.

Owner:COMMISSARIAT A LENERGIE ATOMIQUE ET AUX ENERGIES ALTERNATIVES

Credit exchange system

The invention discloses a credit exchange system comprising servers, a main computer, branch computers and a terminal device. The servers, the main computer, the branch computers and the terminal device implement remote consumption credit and discount, rebate, and exchange services through a communication module under control of an operating system and management software. The credit exchange system can form a multi-component whole to connect credit systems of all merchants within an enterprise alliance, so that members of all the merchants can share the system, consumers can benefit more, and credit exchange can produce maximum effectiveness to the merchants. Smooth overall operation of a project can be ensured through an information management system so as to provide a most stable credit accumulation and exchange environment for consumers. Through the credit exchange service, originally-dispersed credits obtained from the merchants are integrated together, and dispersed members of the merchants are communicated to contribute to a new situation of mutual benefit to the merchants and the consumers. The consumers are directly included in a promotion fee allocation scheme to maximize consumption discount which can be obtained by the consumers.

Owner:YIFENG CULTURE COMM SHANGHAI

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com