Bank risk evaluation system based on user behavior

A risk assessment system and user technology, applied in data processing applications, instruments, biological neural network models, etc., can solve problems such as inability to downgrade bank risks, and achieve the effect of convenient estimation and targeted measures, and accurate input values.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

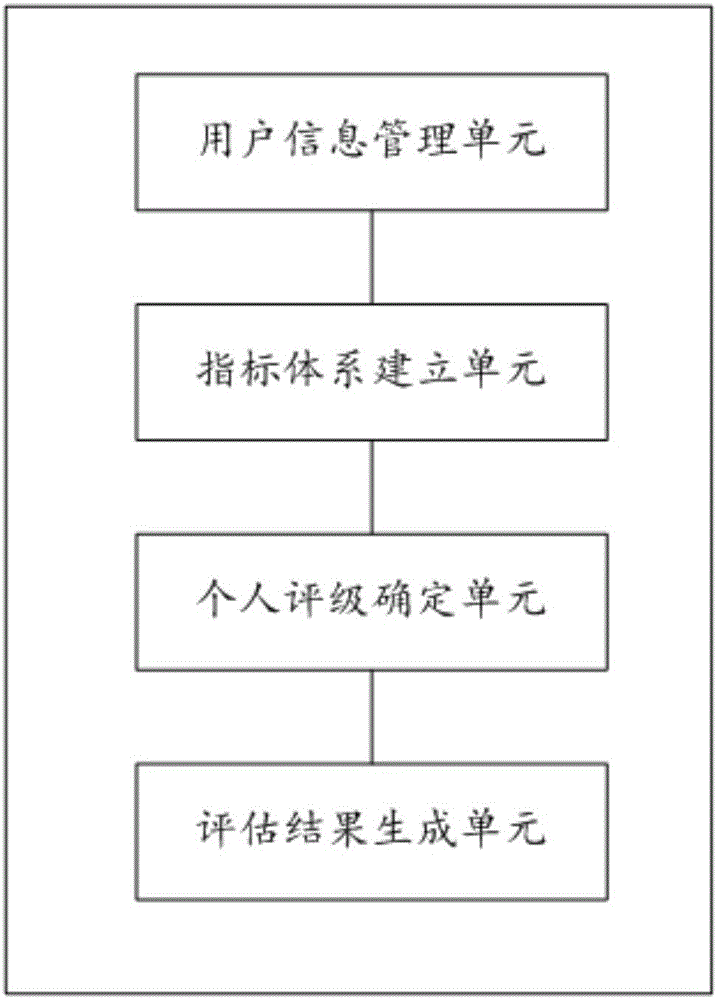

[0027] Such as figure 1 As shown, a bank risk assessment system based on user behavior, which includes the following units:

[0028] The user information management unit is used to obtain the user's basic personal information, value system information, reputation system information, and account information;

[0029] The indicator system establishment unit is used to set the personal basic situation, the value system situation, the reputation system situation and the correlation matrix with the account situation; and set the eigenvector values of each correlation matrix and the single-sort consistency check value; get the user behavior Scoring index system;

[0030] The personal rating determination unit is used to perform weighted calculation on the secondary indicators in the scoring index system to obtain the membership functions of each secondary indicator; judge the user's personal rating status according to each membership function;

[0031] The evaluation result gene...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com