Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

119 results about "Overdraft" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

An overdraft occurs when money is withdrawn from a bank account and the available balance goes below zero. In this situation the account is said to be "overdrawn". If there is a prior agreement with the account provider for an overdraft, and the amount overdrawn is within the authorized overdraft limit, then interest is normally charged at the agreed rate. If the negative balance exceeds the agreed terms, then additional fees may be charged and higher interest rates may apply.

Method, transaction card or identification system for transaction network comprising proprietary card network, eft, ach, or atm, and global account for end user automatic or manual presetting or adjustment of multiple account balance payoff, billing cycles, budget control and overdraft or fraud protection for at least one transaction debit using at least two related financial accounts to maximize both end user control and global account issuer fees from end users and merchants, including account, transaction and interchange fees

InactiveUS20070168265A1Increase flexibilityEasy maintenanceComplete banking machinesFinanceCredit cardFinancial transaction

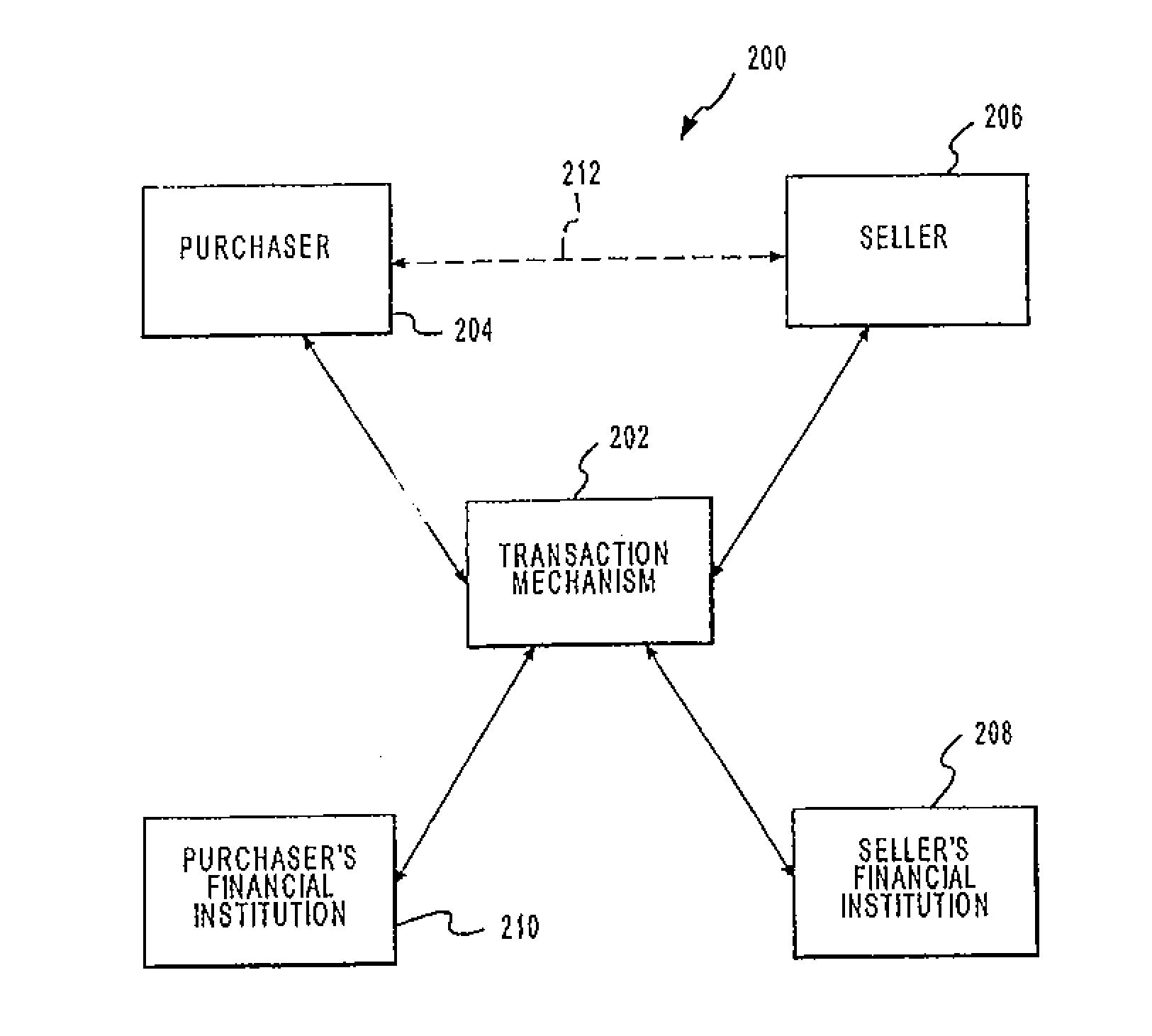

The present invention provides methods, systems and transaction cards or identification systems, using transaction network comprising proprietary card network, EFT, ACH, or ATM, for end user management of a global financial account by manual or automatic prepaying, prepaying, paying or unpaying, debiting or crediting, or readjustment or presetting, using parameters relating to portions of paid or unpaid financial transactions or account balance amounts in multiple credit, cash or other existing, or end user created, financial accounts or sub-accounts in said global financial account that is optionally subject to financial account issuer transaction or readjustment fees from end users and merchants, including optional use for financial transactions as a credit transaction card requiring merchant credit card interchange or other fees, and optional end user fees, as additional revenue to the global account issuer.

Owner:ROSENBERGER RONALD JOHN

Method, system, and computer program for on-demand short term loan processing and overdraft protection

A method, system, and computer program for on-demand short term loan processing and overdraft protection is disclosed which utilizes computing equipment (10) to expedite and facilitate loan approval, overdraft protection, and the transfer of funds. The method generally includes the steps of: establishing a customer account for a customer; receiving a request for overdraft protection from the customer; utilizing computing equipment to approve the request for overdraft protection; receiving a request for funds due to a transaction initiated by the customer; utilizing computing equipment to automatically provide an overdraft protection amount when the customer account lacks sufficient funds to cover the initiated transaction; and automatically withdrawing the overdraft protection amount and an overdraft fee from the customer account when additional funds are deposited into the customer account.

Owner:TUCKER SCOTT A

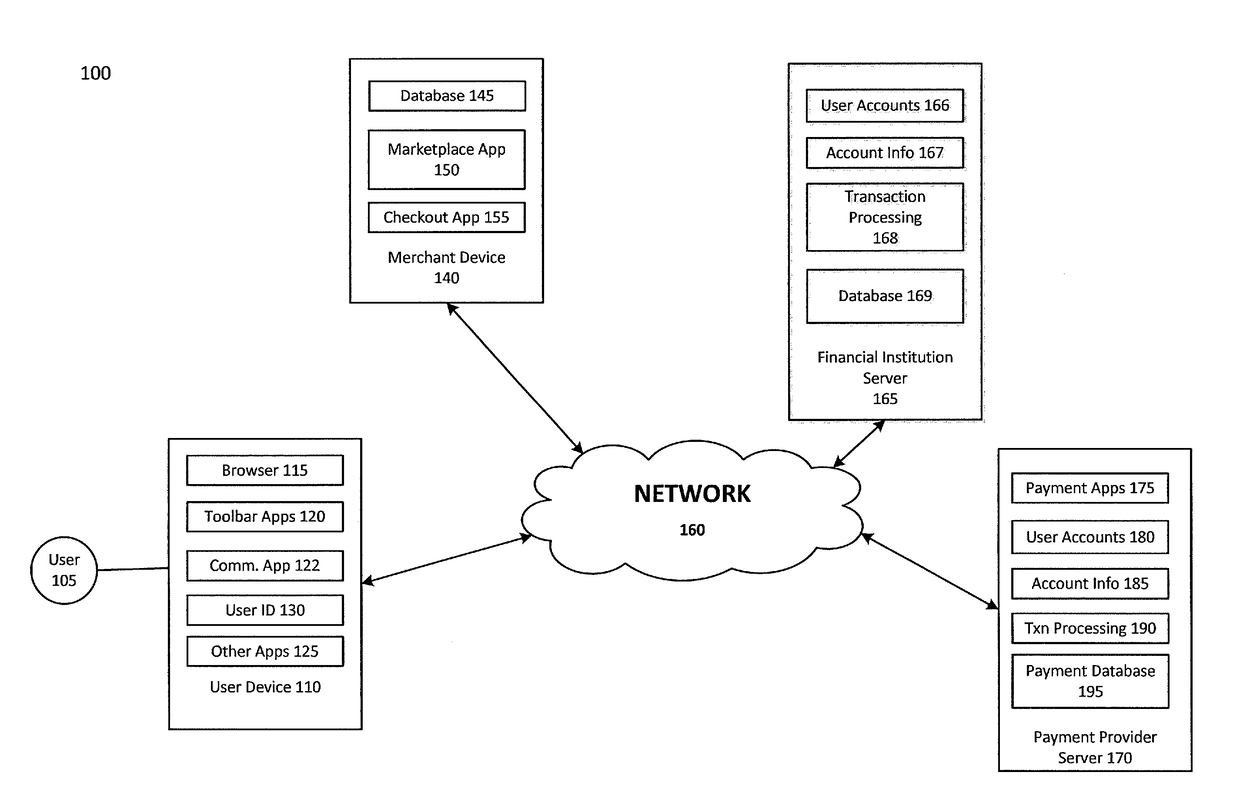

Customer refunds using payment service providers

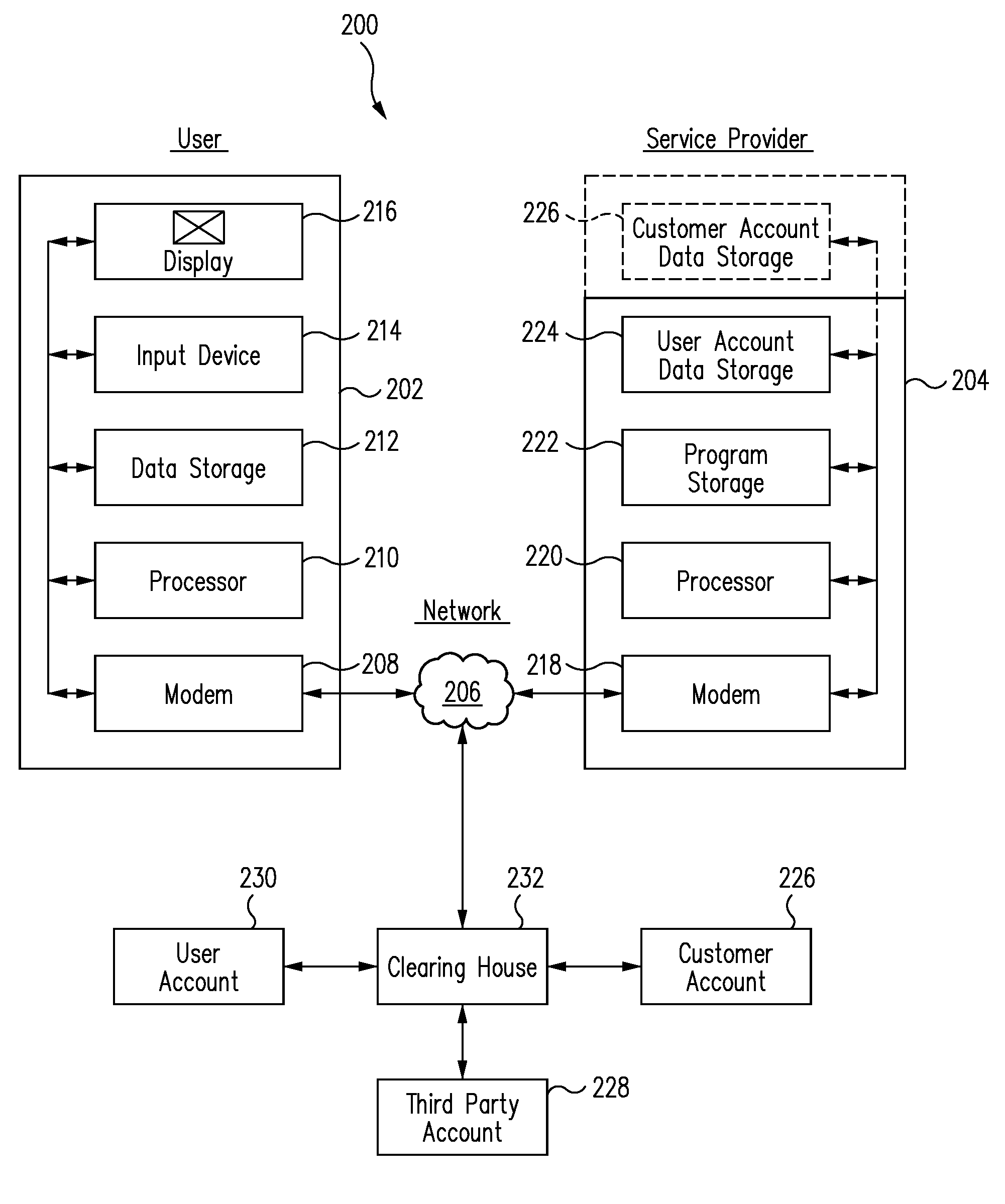

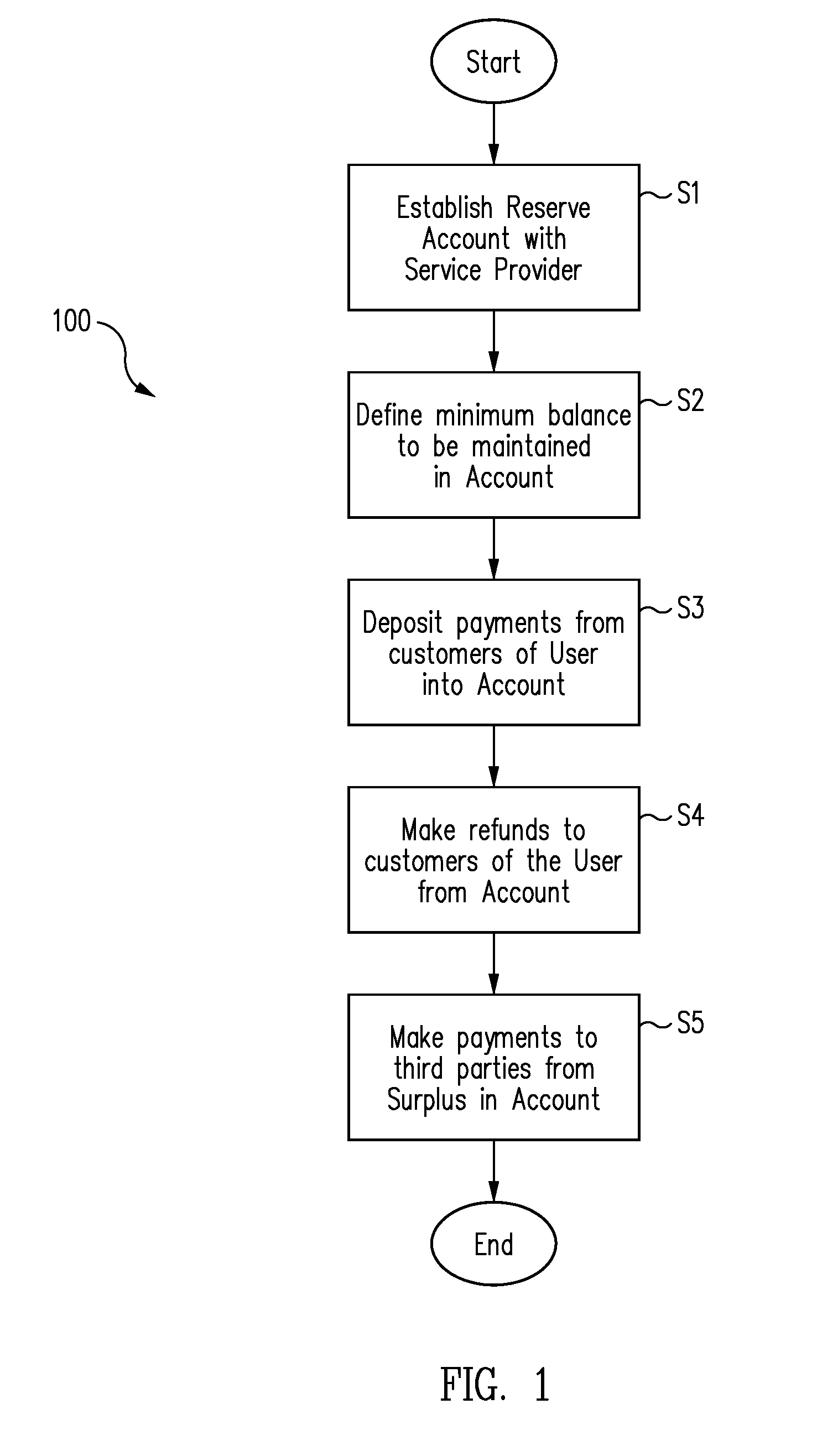

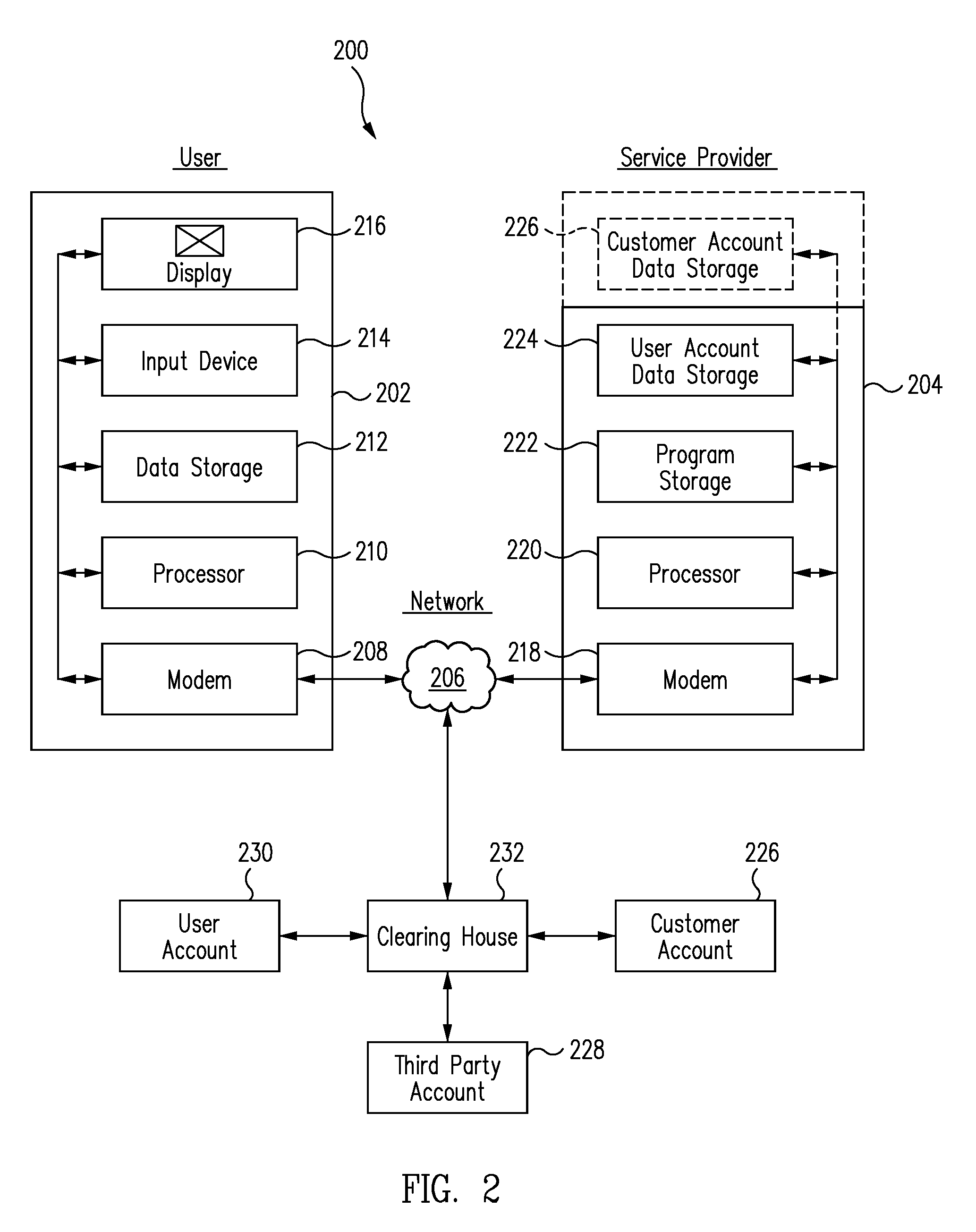

A method by which a merchant can establish and advantageously use an account at an online payment service provider for making both payments and refunds to customers so as to minimize overdraft or non-sufficient funds (NSF) occurrences and the attendant delays and loss of customer good will includes providing at least one processor communicating through at least one network, and using the at least one processor and network to receive a refund request, access a user reserve account with an online payment service provider, wherein the reserve account is associated with a regular account of the user with the payment service provider, and processing the refund request from the reserve account.

Owner:PAYPAL INC

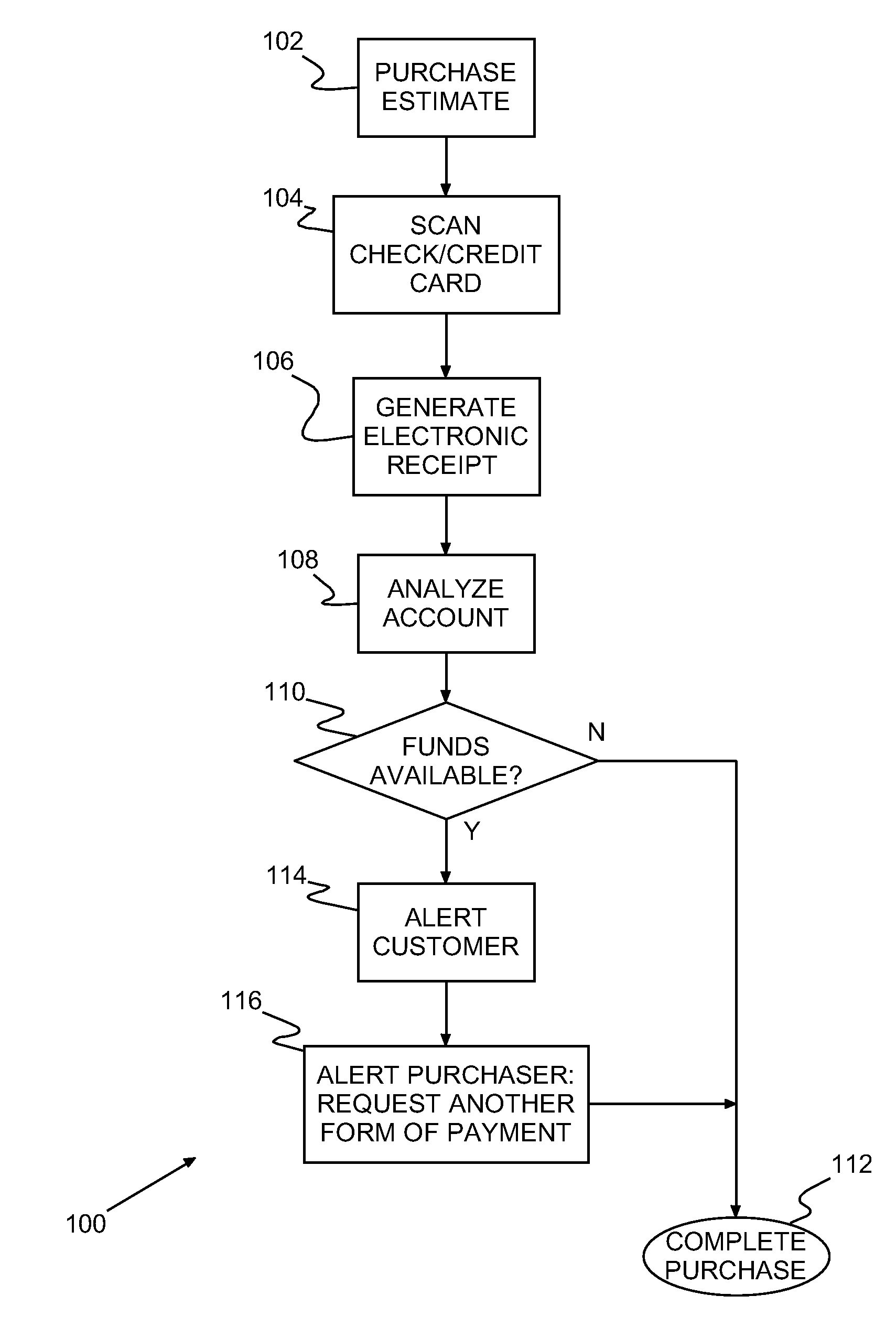

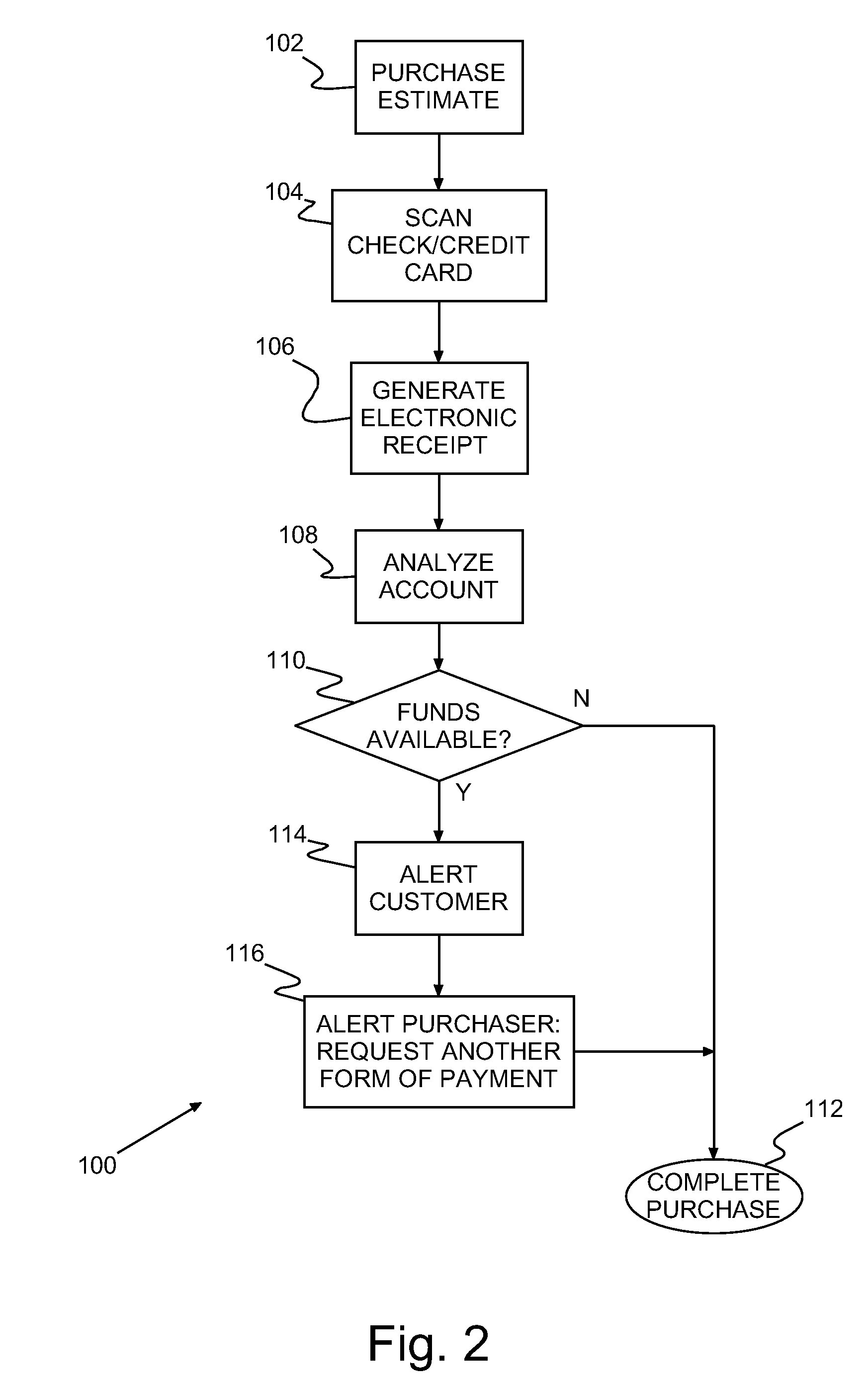

System and method of automatic insufficient funds notification and overdraft protection

InactiveUS20070106558A1Reduce expenditureReduce inadvertent overdrafts in point-of-sale terminal purchasesFinanceReceipt giving machinesCredit cardCheque

A method and program product for conducting business transactions and avoiding inadvertent overdrafts. First, the value of an intended purchase is estimated and an electronic receipt is generated for the estimate. An account identified for payment (e.g., a checking account or a credit card account) is analyzed for sufficient funds and, alerts may be provided whenever the analysis indicates that the account has insufficient funds. As a result of the alert, the purchase may be halted or another form of payment may be selected. Also, total in-store purchases may be estimated and other accounts may be analyzed to determine if, in addition to being overdrawn for the selected account, the transaction is over budget.

Owner:INT BUSINESS MASCH CORP

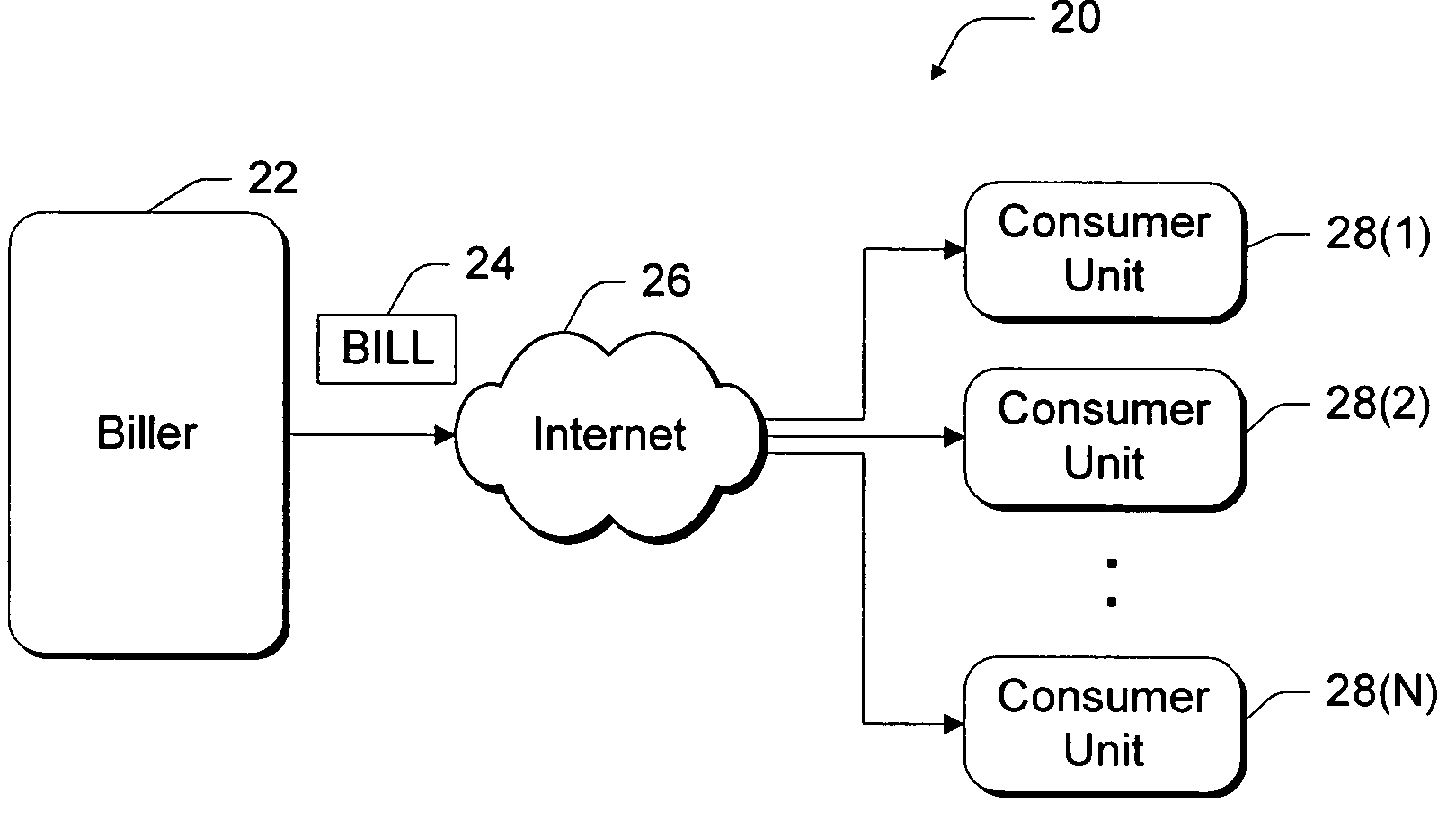

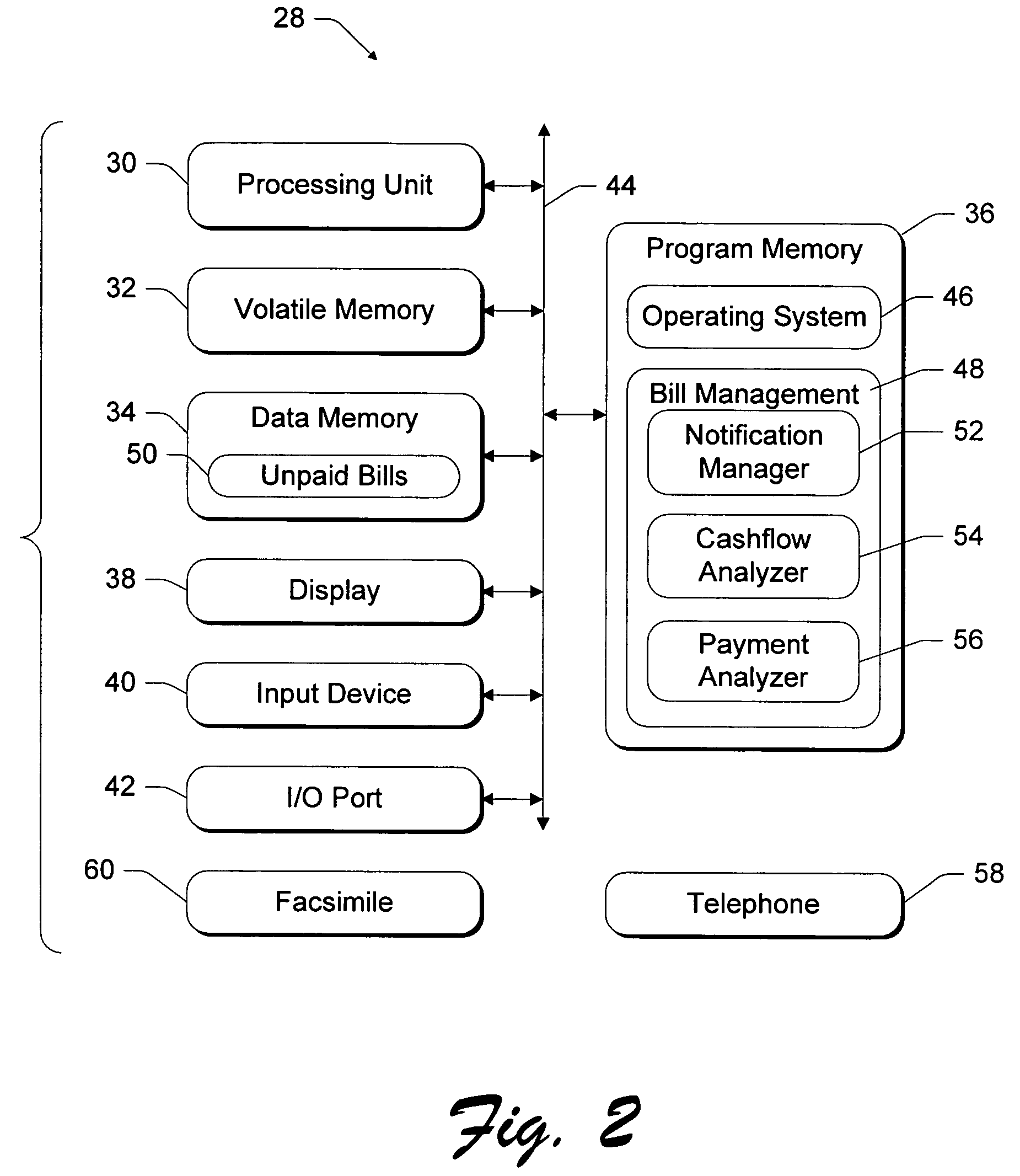

Consumer-based system and method for managing and paying electronic billing statements

InactiveUS6839687B1Minimizes overdraftMaximize balanceComplete banking machinesFinancePayment scheduleGraphics

A consumer-based bill management and payment system is configured to receive, analyze, manage and pay electronic billing statements received from the biller over the Internet. The system includes a notification manager that detects when the electronic bill arrives and notifies the consumer. The bill is stored in memory with other unpaid electronic bills. According to another aspect of the invention, the system has a cashflow analyzer that enables the consumer to coordinate the unpaid electronic bills according to different payment schedules for a bill payment cycle (e.g., a month). The goal of the manipulation is to permit the consumer to analyze how the different payment schedules affect the consumer's cashflow with an aim toward minimizing overdraft during the bill payment cycle. The cashflow analyzer can automatically compute an optimized payment schedule that minimizes overdraft of the consumer's account, while maximizing the balance to generate the most interest. When the consumer desires to pay a particular bill, the bill is presented to the consumer through a graphical user interface (UI). The bill management and payment system supports a payment analyzer to enable the consumer to determine how much of the electronic bill to pay. The payment analyzer provides a venue to challenge certain items on the bill.

Owner:MICROSOFT TECH LICENSING LLC

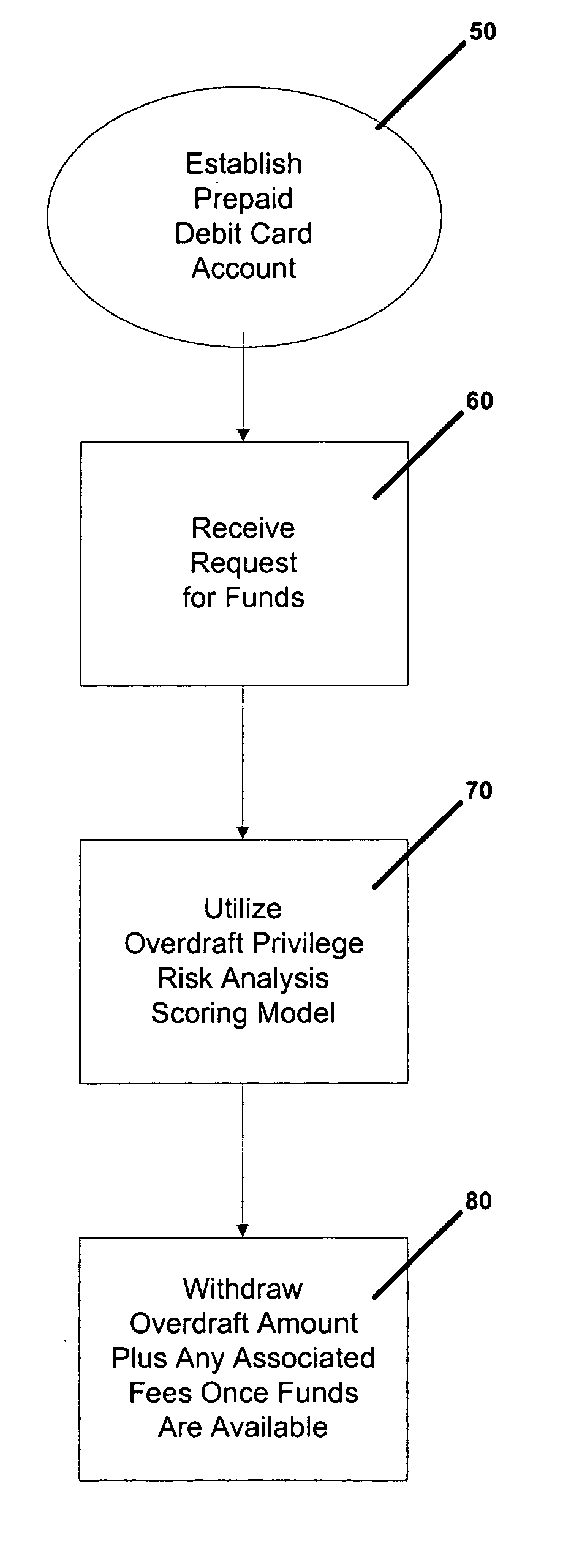

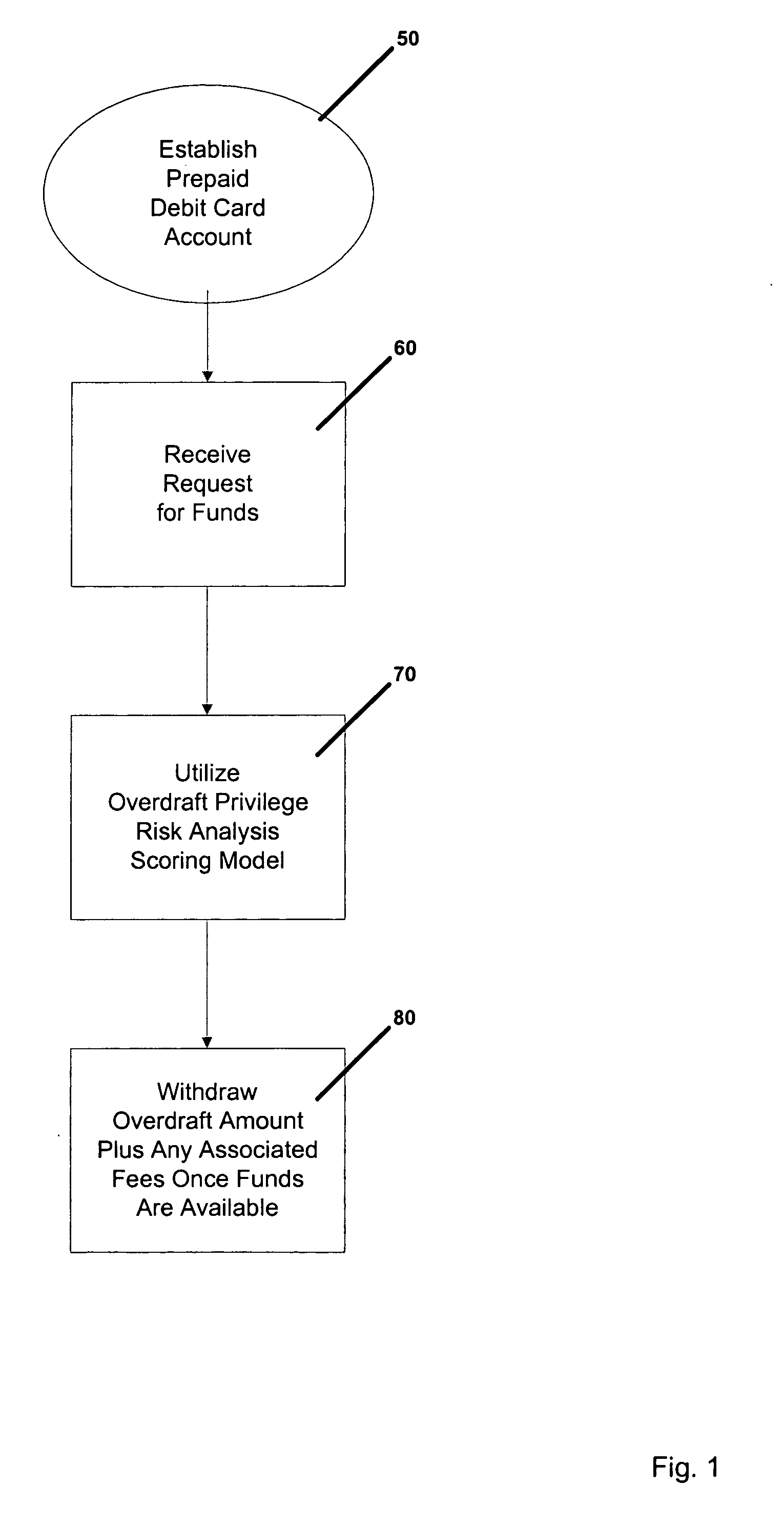

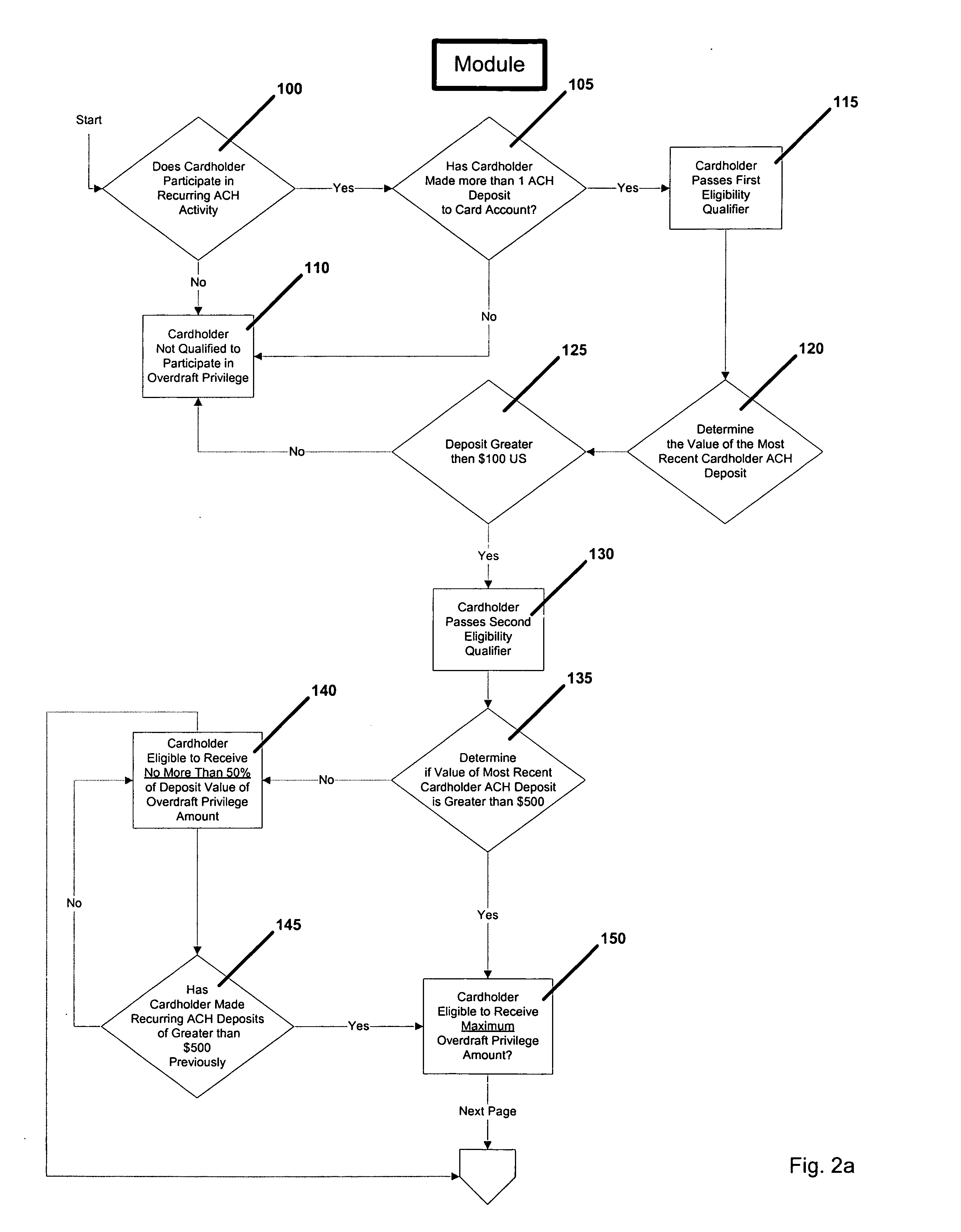

Method for prepaid debit card with overdraft capabilities

Owner:CNG FINANCIAL CORP

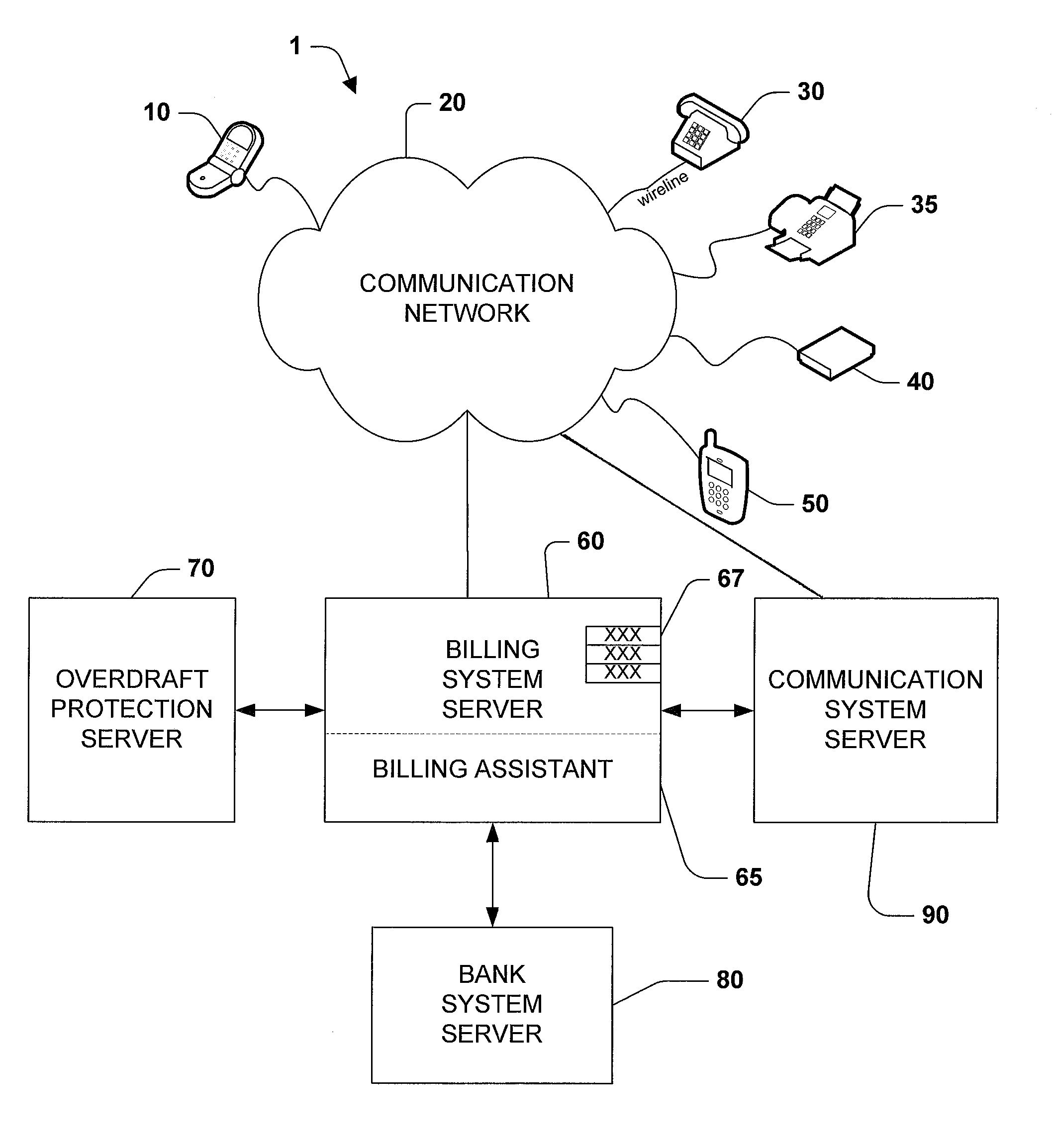

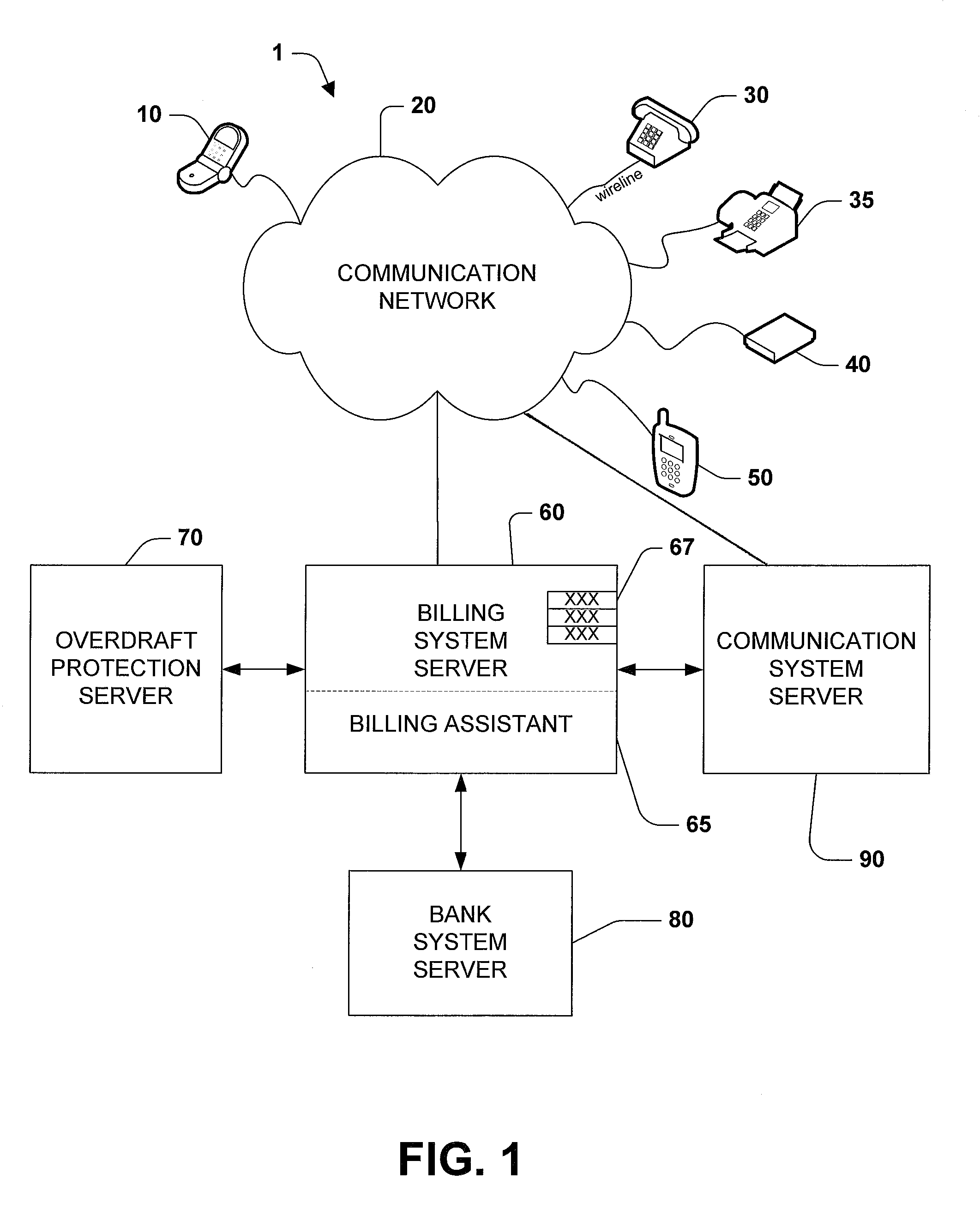

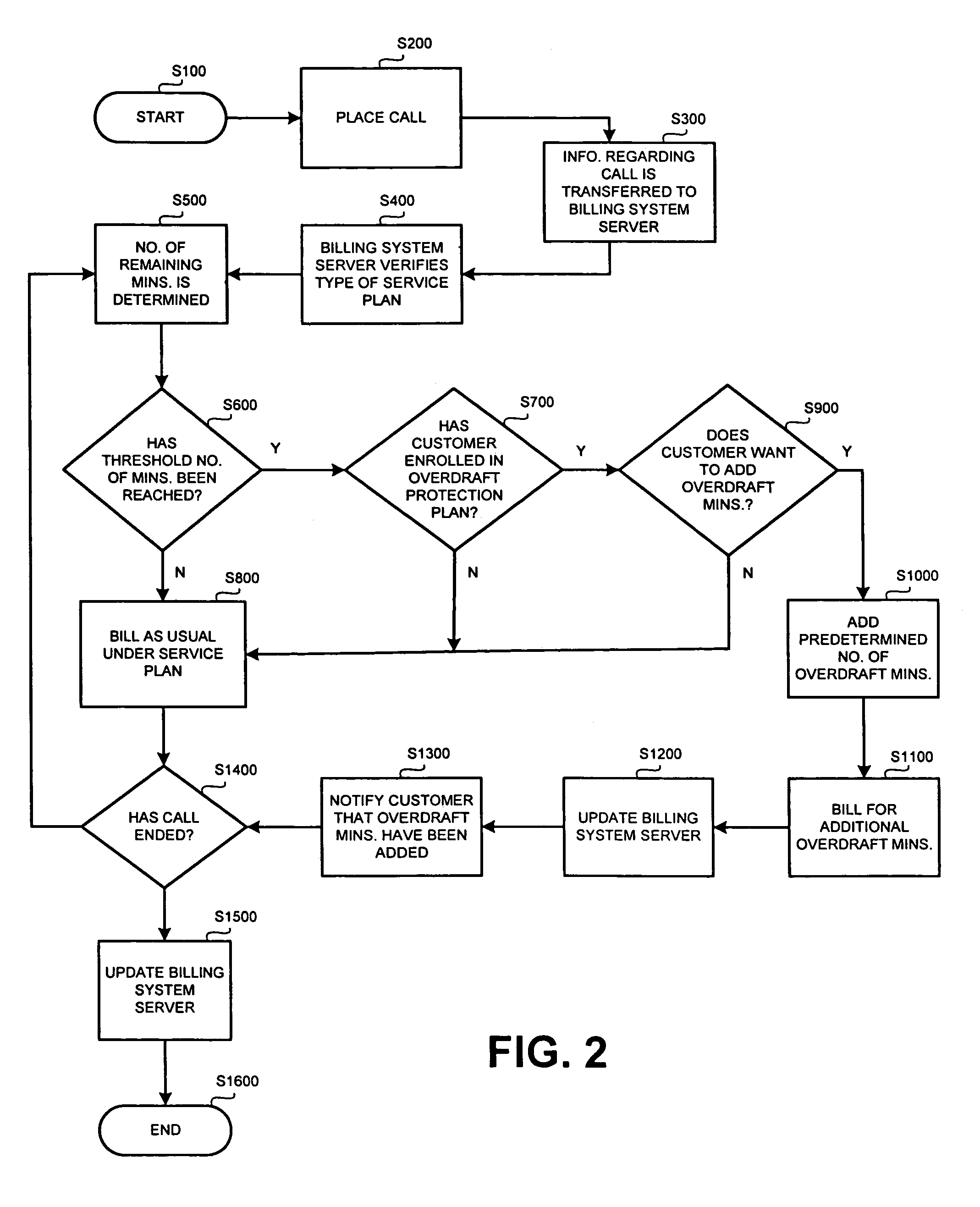

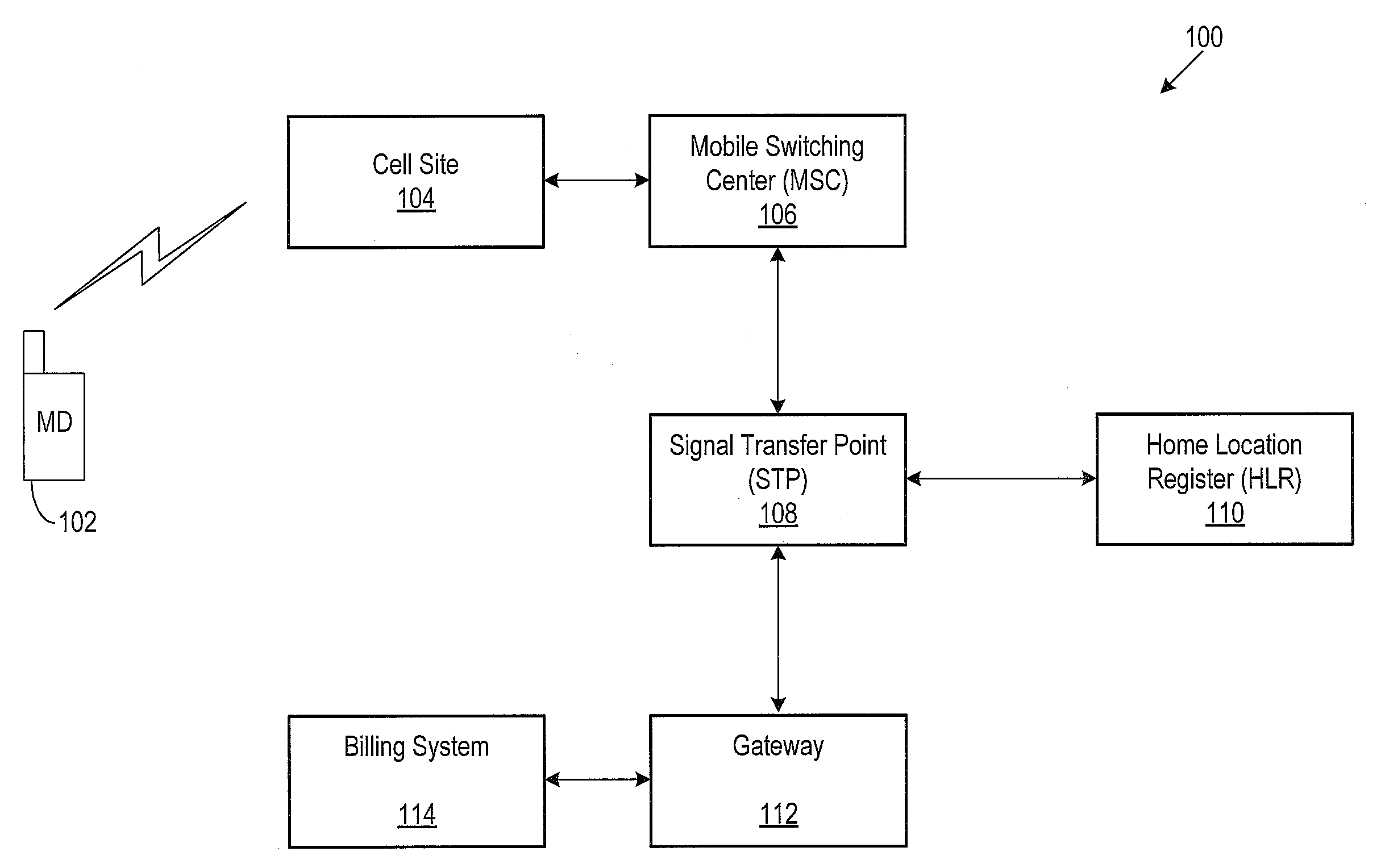

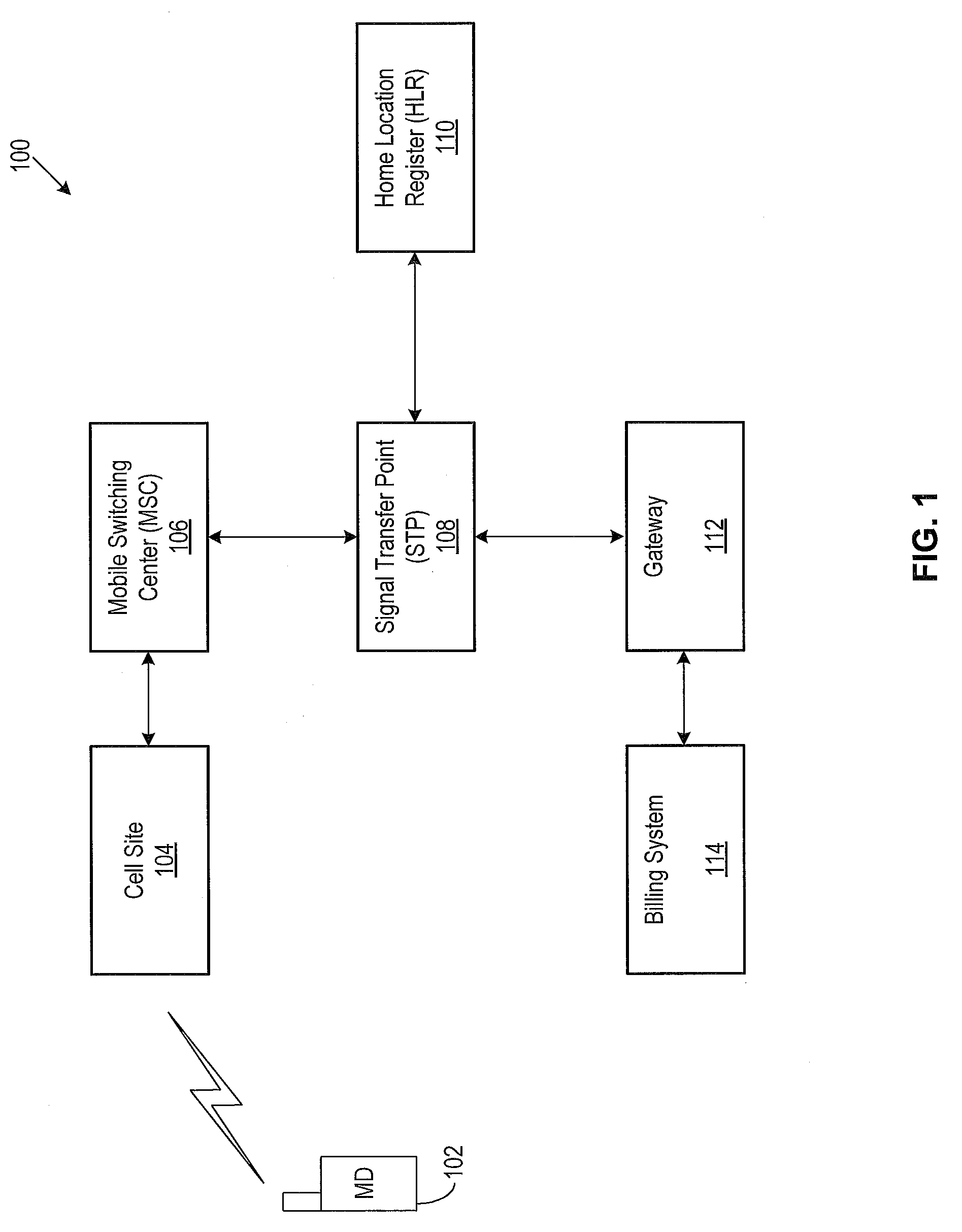

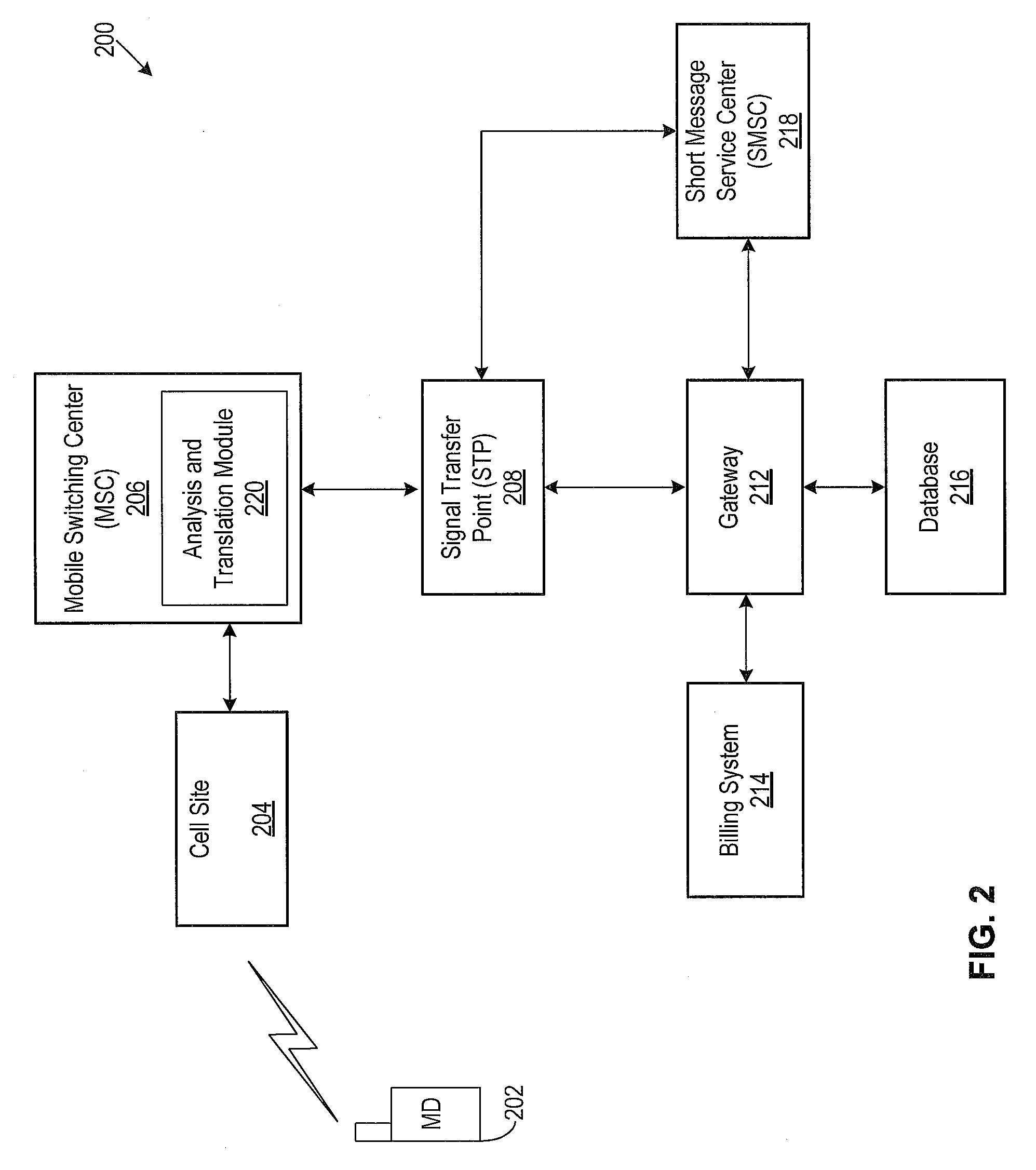

Methods for providing overdraft protection for post-paid communication service plans

ActiveUS7450928B1Cost controlIncreased overage costMetering/charging/biilling arrangementsAccounting/billing servicesCommunication PlanIndustrial engineering

Methods for adding minutes to a calling plan having a calling plan period. The methods including determining whether a threshold number of minutes have been reached during the calling plan period; and incrementally adding minutes to the calling plan when the threshold number of minutes has been reached. The cost per minute of the added minutes is less than the high-cost per minute rate normally associated with exceeding the threshold number of minutes during the calling plan period.

Owner:CINGULAR WIRELESS II LLC

System and method for providing airtime overdraft protection

InactiveUS20060276180A1Accounting/billing servicesPrepayment with on-line account/card rechargingInternet privacySystem monitor

A system for providing airtime overdraft protection is provided. In an exemplary embodiment, the system monitors or checks airtime usage of a user and determines if the user has reached an airtime threshold value. If the airtime threshold value is reached, a notification is sent to the user. The user then has an option to purchase additional discount airtime minutes in response to the notification.

Owner:CINGULAR WIRELESS II LLC

Methods and systems for accepting offers via checks

In accordance with one or more embodiments, a method and system are provided for facilitating the output of an offer to an account holder of a financial account, which offer the account holder may accept via a check being presented by the account holder as payment for a transaction. For example, the account holder may alter an indicium on the check to indicate acceptance of the offer. An example of an offer is an offer to sell to the account holder transactional overdraft protection for the transaction for which a check is provided as payment. Another example of an offer to provide a benefit to the account holder in exchange for a commitment by the account holder to an obligation. Such an offer may be provided by, for example, a merchant different than the merchant at which the check is being provided as payment for a transaction. In one or more embodiments, the offer or an indication of the offer may be printed on the check or handwritten on the check.

Owner:PAYPAL INC

Systems and methods for transaction processing based upon an overdraft scenario

InactiveUS8190514B2Convenient transactionHand manipulated computer devicesFinanceTransaction processing systemAuthorization

Facilitating commercial transactions using a payment system directory are disclosed. A payment directory and / or wireless point of sale (POS) device may be configured to use predetermined rules, a multitude of data items and / or conditions to locate a payment system, and transmit a payment authorization request from a remote location to at least one payment system, either directly, or via a payment system directory and / or a SSL Gateway.

Owner:LIBERTY PEAK VENTURES LLC

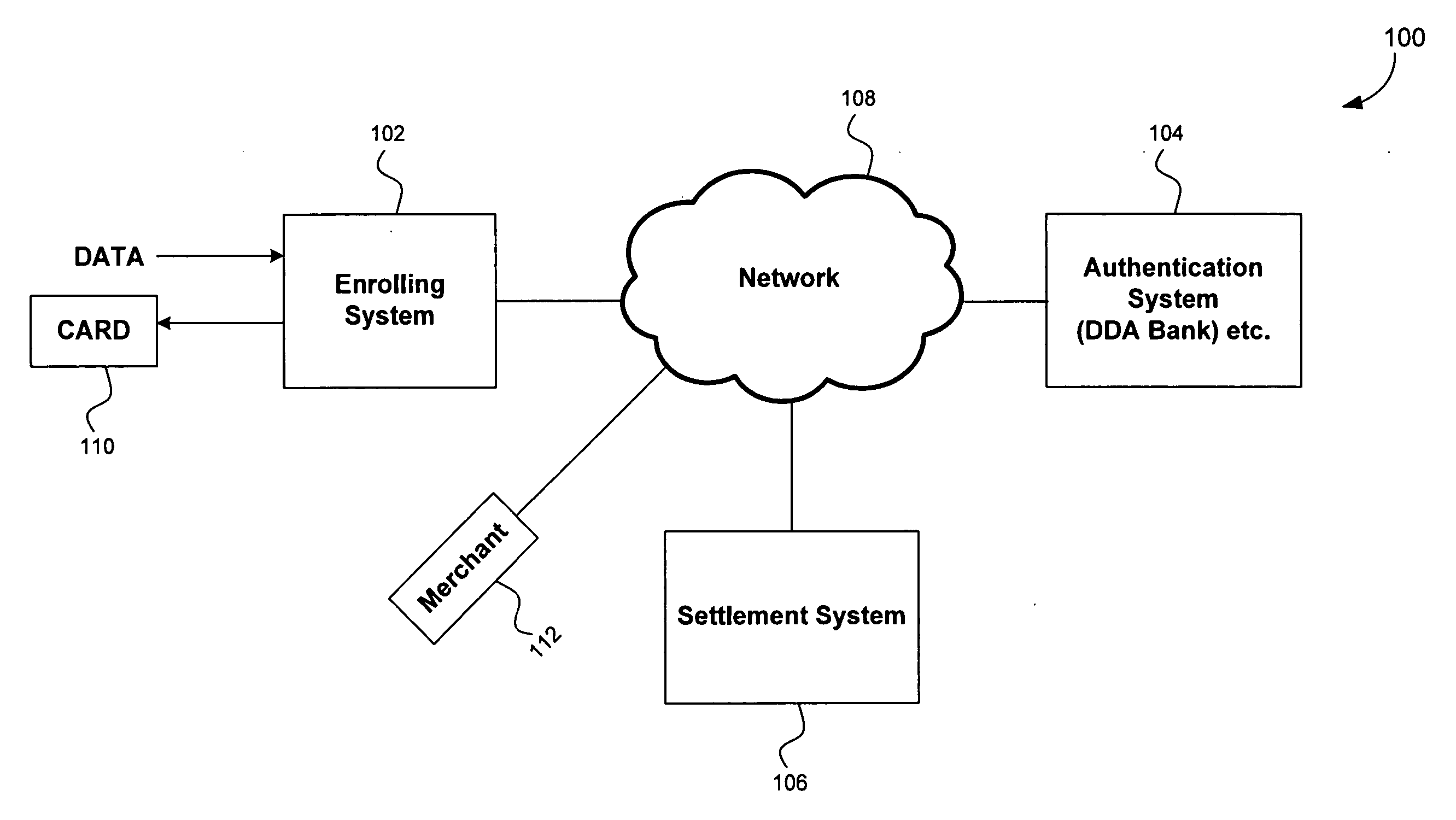

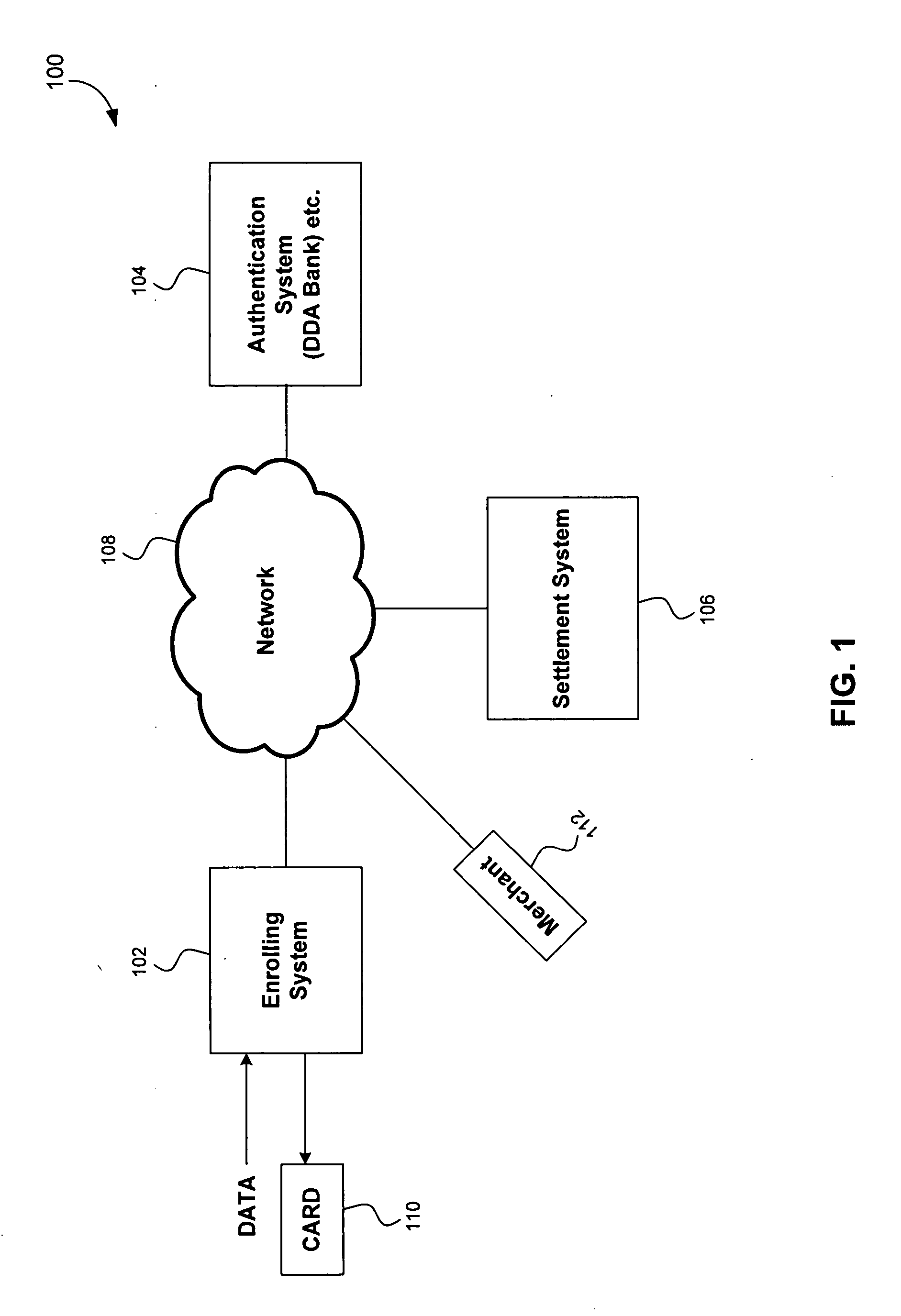

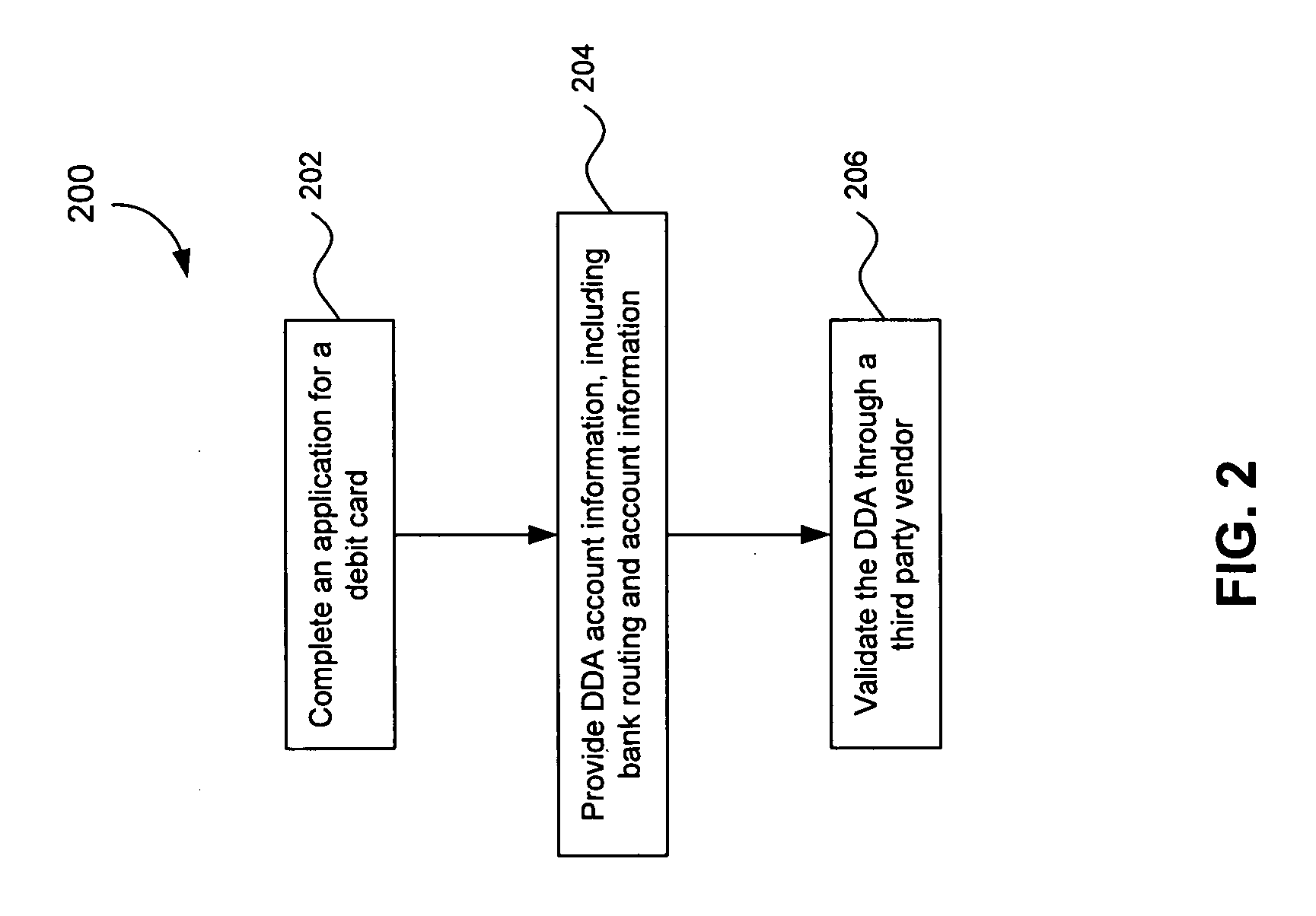

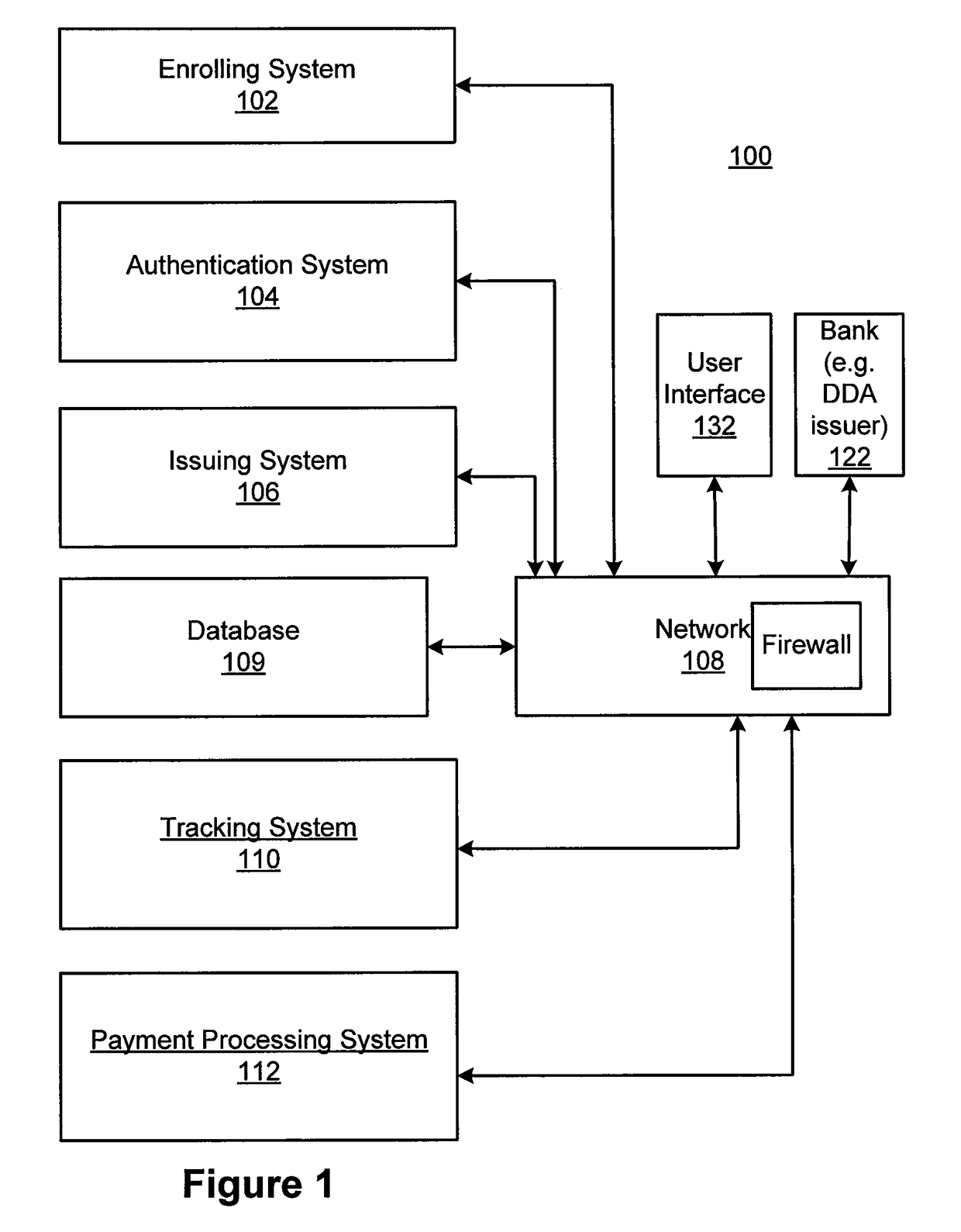

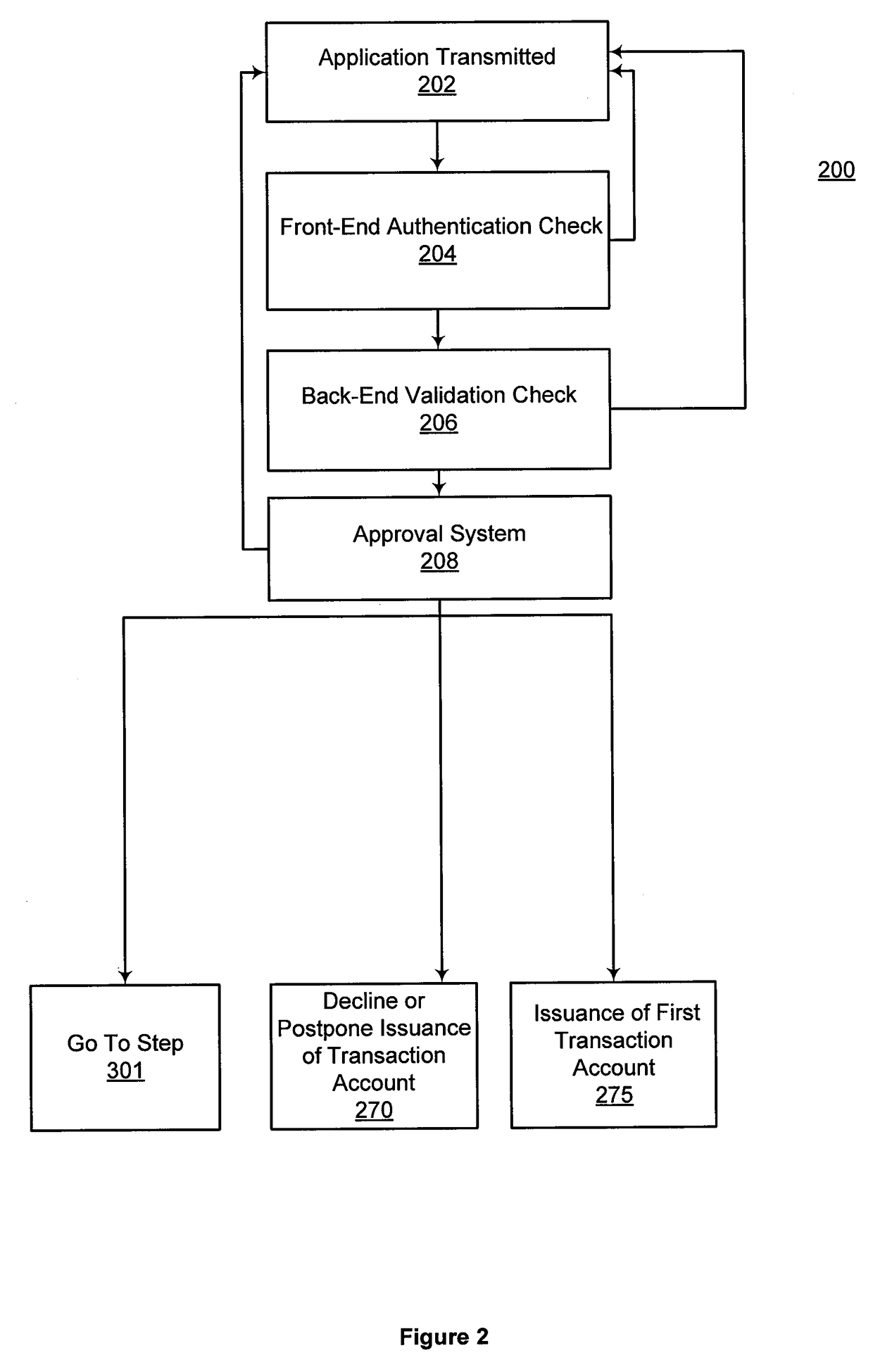

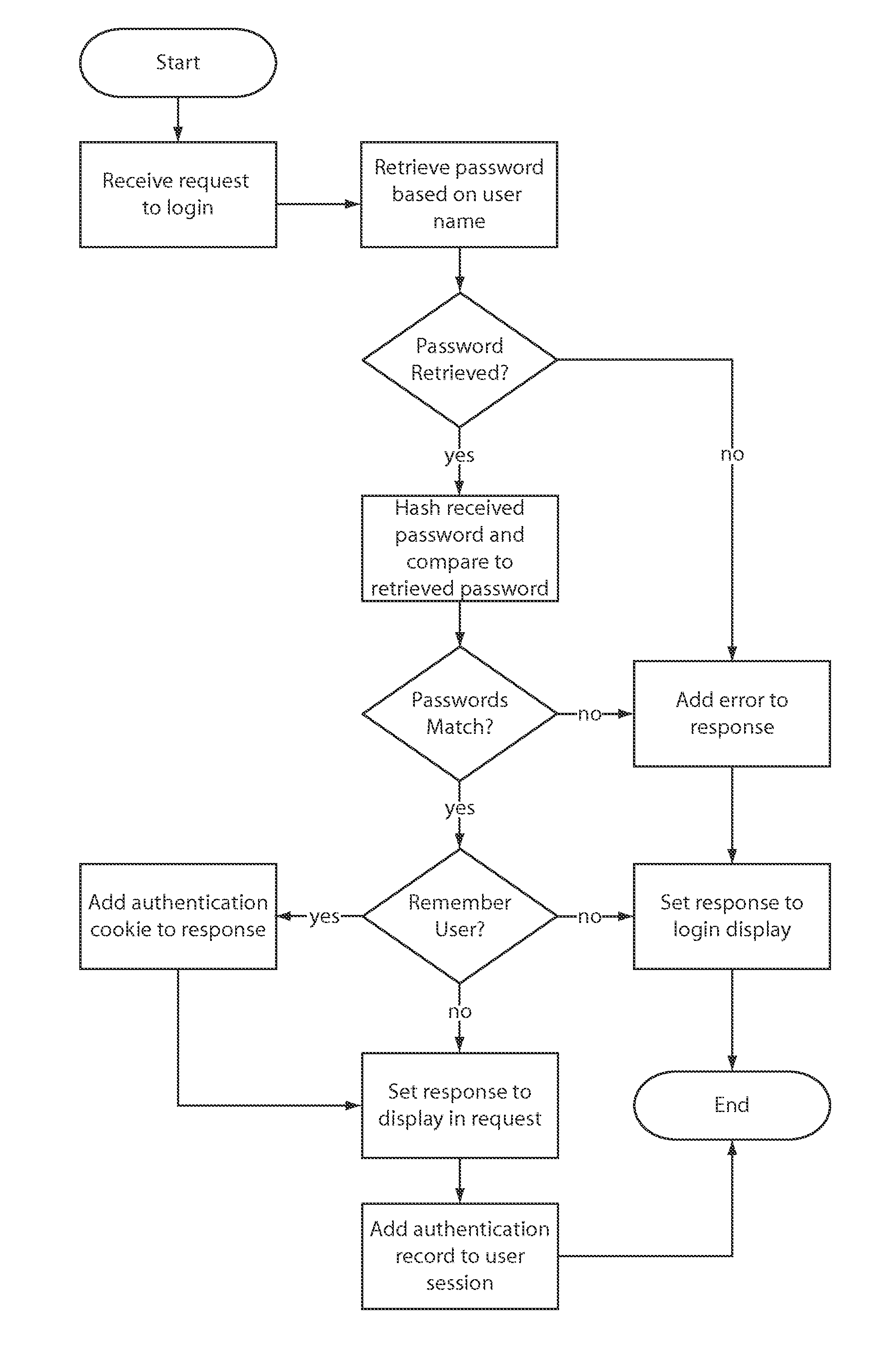

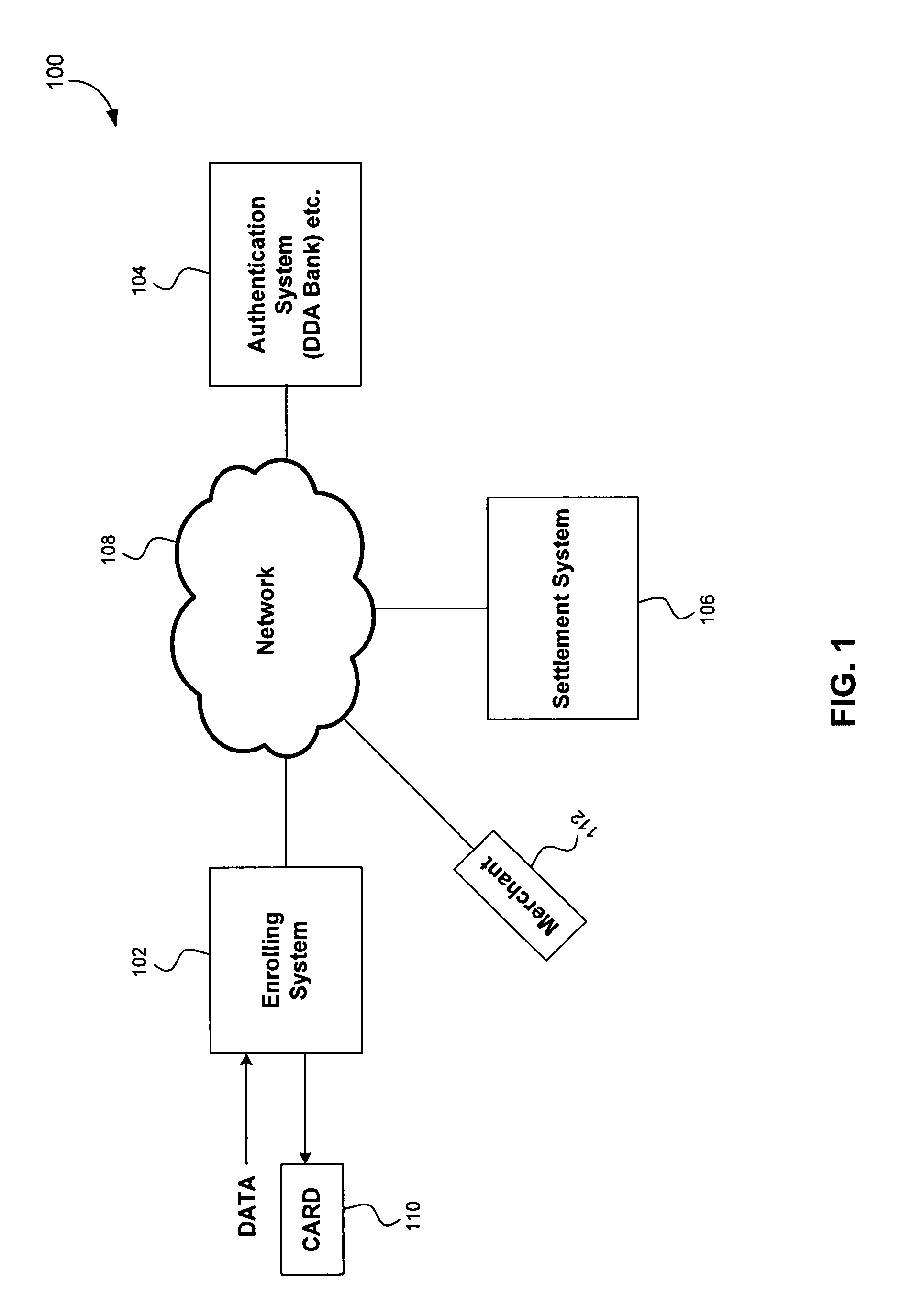

System, method, and computer program product for issuing and using debit cards

A system, method, and computer program product are used to issue and track debit cards. A system comprises an enrolling system that verifies an enrollee, associates an enrollee's main and overdraft account, and issues a debit card, an authentication system that receives information regarding a requested transaction of a debit card and that receives information regarding the main and overdraft account associated with the debit card and accepts or rejects the requested transaction based thereon, and a settlement system that generates a periodic report of at least one of the transactions, the main account, and the overdraft account. The overdraft account can be a charge or credit account.

Owner:LIBERTY PEAK VENTURES LLC

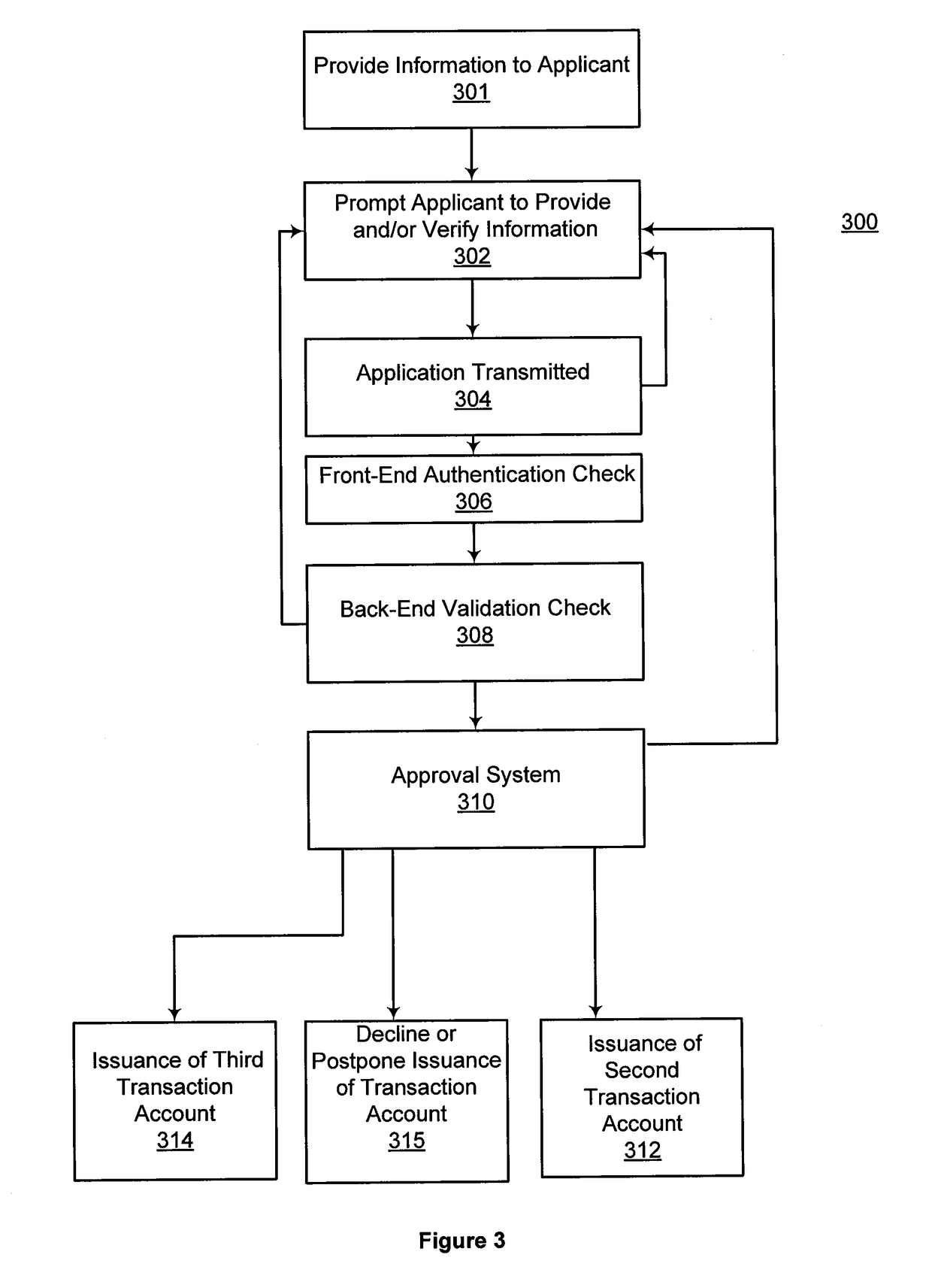

System, method, and computer program product for issuing automatic payments linked transaction account

InactiveUS8473394B2Facilitate increasing an individual's credit scoreEasy constructionFinanceCommerceDatabaseTransaction account

An enrolling system verifies an enrollee, counter-offers a second transaction account in response to a decline of a first account, wherein the second transaction account includes more restrictions than a first transaction account, associates an enrollee's main and overdraft account, and issues a transaction account. Enrolling in the second transaction account may include enrolling in a second transaction account automatic payment program; and / or associating a demand deposit account to the second transaction account. The method may also include relaxing use restrictions of the transaction account based upon at least one of: receiving payment of a pre-selected amount, receiving payments over a pre-selected period, and receiving payment on or before a pre-selected date.

Owner:LIBERTY PEAK VENTURES LLC

Systems and methods for transaction processing based upon an overdraft scenario

InactiveUS20090271277A1Facilitates purchase transactionConvenient transactionHand manipulated computer devicesFinanceTransaction processing systemAuthorization

Facilitating commercial transactions using a payment system directory are disclosed. A payment directory and / or wireless point of sale (POS) device may be configured to use predetermined rules, a multitude of data items and / or conditions to locate a payment system, and transmit a payment authorization request from a remote location to at least one payment system, either directly, or via a payment system directory and / or a SSL Gateway.

Owner:LIBERTY PEAK VENTURES LLC

Financial, account and ledger web application and method for use on personal computers and internet capable mobile devices

InactiveUS20110196795A1Accurate account balanceBetter segregate moneyComplete banking machinesFinanceWeb applicationThe Internet

The method and web application is for users of cellular mobile devices to keep track of their personal finances while the user is mobile. The web application is accessed via internet capable mobile devices to record financial transactions such as debit, credit, and cash transactions at the point of the transaction, to avoid lost or forgotten transactions and avoid bank overdraft charges. The method and web application will provide five sets of tools as a service to customers. These sets are: Account ledger, account balancing tools, bill and debt management, budgeting tools, and user management tools.

Owner:POINTER IVAN ANDREW

System, method, and computer program product for issuing and using debit cards

A system, method, and computer program product are used to issue and track debit cards. A system comprises an enrolling system that verifies an enrollee, associates an enrollee's main and overdraft account, and issues a debit card, an authentication system that receives information regarding a requested transaction of a debit card and that receives information regarding the main and overdraft account associated with the debit card and accepts or rejects the requested transaction based thereon, and a settlement system that generates a periodic report of at least one of the transactions, the main account, and the overdraft account. The overdraft account can be a charge or credit account.

Owner:LIBERTY PEAK VENTURES LLC

Method and apparatus for finance-based scheduling of construction projects

a method and apparatus is disclosed for scheduling construction projects based on the available finance using integer programming. This method renders CPM / PERT schedules of construction projects executable using bank overdrafts of specified credit limits. Conveniently, the method is organized in three stages; input preparation, schedule extension, and model formulation. Input preparation stage supports preparing CPM / PERT schedule and financial data of the project. Schedule extension stage supports developing a scheme for schedule extension. The scheme is a framework of the original schedule that allows a definite extension increment in the critical path of the CPM. Model formulation stage supports building an integer programming model for the scheme and involves the components of formulating an objective function, setting constraints, and searching for a model solution. The model solution determines the activities' shifts that fulfill the constraints of the specified credit limit while minimizing the schedule extension. A search for a solution of the model is performed. If no solution is found, a repetition of the last two stages of the method is performed after allowing longer extension increment.

Owner:KING FAHD UNIVERSITY OF PETROLEUM AND MINERALS

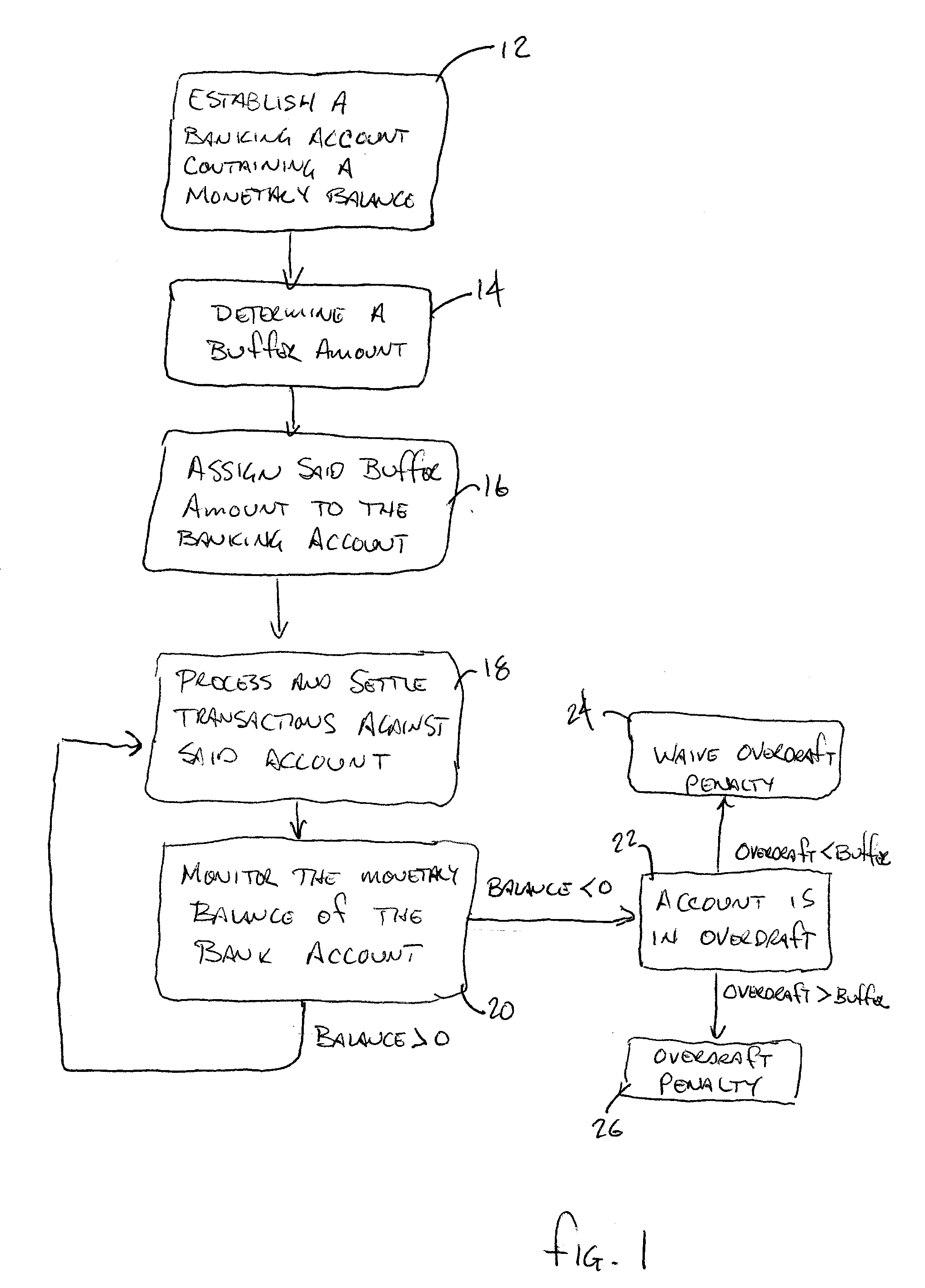

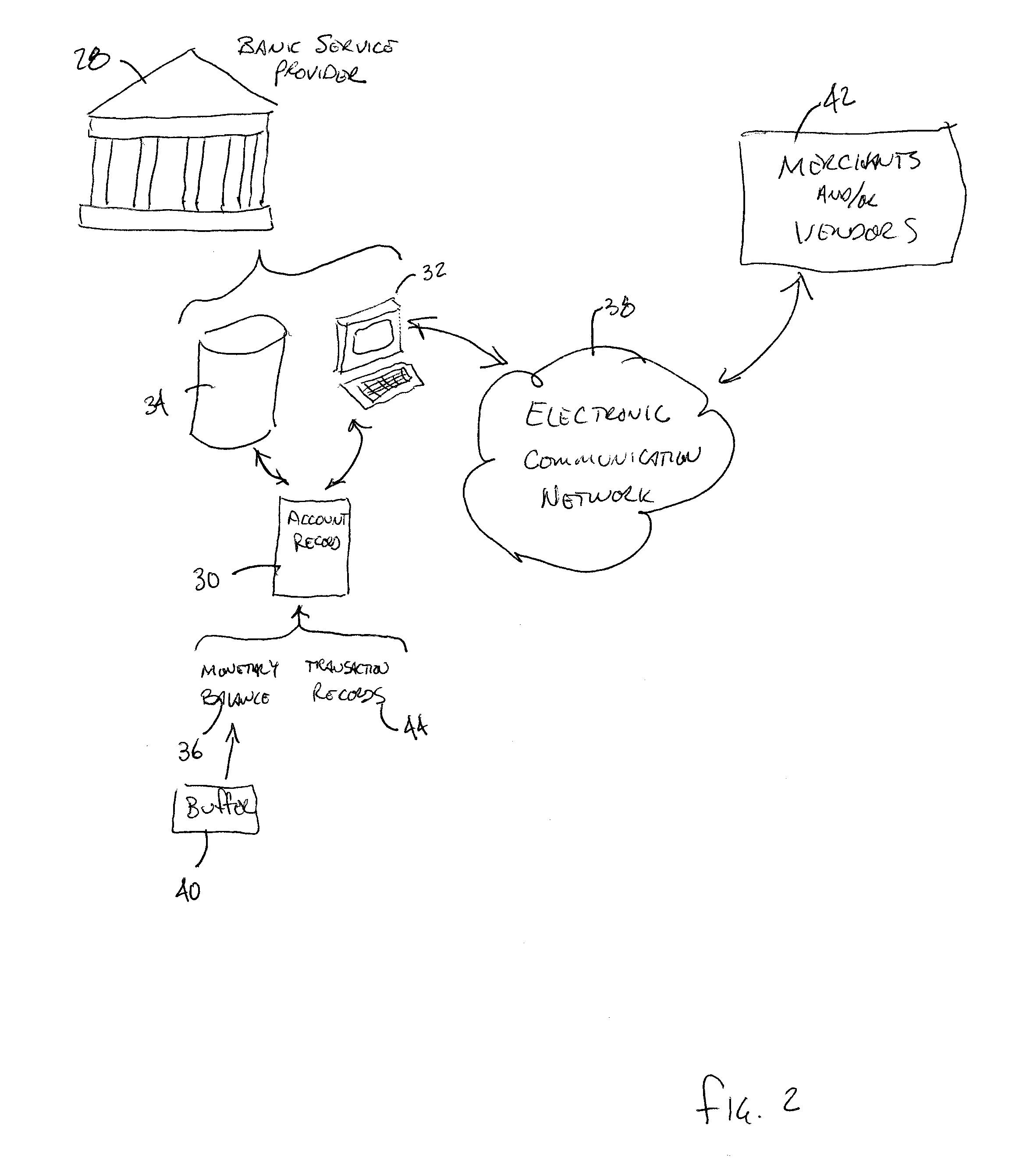

Method of providing an account that employs a buffer against overdrafts

A method and system is provided for establishing a buffer to protect a banking customer against over drafting a bank account. The invention provides a bank account that includes a buffer attached thereto wherein the buffer allows the account holder to exceed their account value within the predetermined range without risk of incurring overdrafts or the resulting overdraft fees associated therewith. A customer establishes a banking account that contains a monetary balance therein. A buffer amount is assigned to the account. The buffer is a monetary value in excess of the balance within the account. As debits are settled against the account they are deducted from the balance. Should one or more transactions cause the value of the account to drop below the balance the account is in an over draft condition, but provided the overdraft amount is less than the buffer, the traditional overdraft fees are waived.

Owner:RBS CITIZENS FINANCIAL GRP

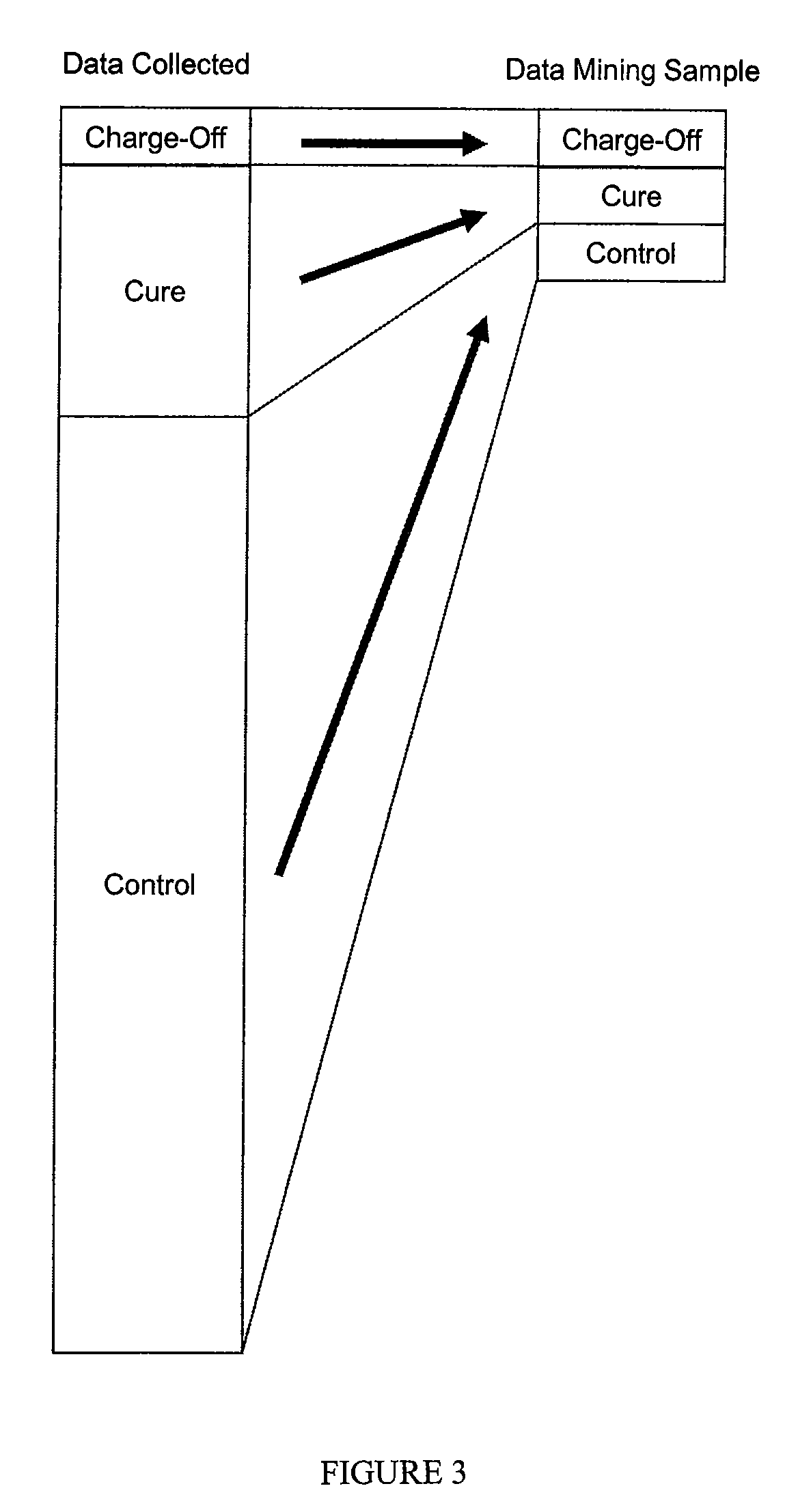

Method for minimizing overdraft charge-off

A method for minimizing overdraft charge-off in a bank account includes:(a) identifying a plurality of factors that can result in a bank account charge-off;(b) building a case history database of bank account holder information based upon a plurality of data elements associated with each of the plurality of factors;(c) creating numeric and / or categorical representations of the bank account holder information for each of the bank accounts in the case history database;(d) tabulating the numeric and / or categorical representations and the data elements for the bank accounts in the case history database;(e) combining certain ones of the numeric and / or categorical representations to separate the bank accounts in the case history database into a plurality of risk groups, each risk group having an associated probability of charge-off; and(f) optimizing, for each of the plurality of risk groups, a bank profit, by setting overdraft limits.

Owner:CARREKER CORORATION A DELAWARE

Preemptive data processing to mitigate against overdraft and declined transaction

A system or method may implement an overdraft prediction analysis to predict whether an account overdraft is about to occur. The overdraft prediction analysis may be based on: 1. customer account data, such as current account balance, historical balances, historical withdrawals, historical deposits balance trends, and the like; 2. account transaction data, such as routine or recurring account transactions, timing of transactions, amount, deposit or withdrawal transactions, and the like; 3. location data, such as locations of past purchases or payments; and 4. time and date data, such as dates and times of past transactions. Other factors, such as credit score, loan activities, social data, or the like also may be used for the overdraft prediction analysis. Once an overdraft situation is predicted, the system or method may provide options for the users to avoid or mitigate the potential account overdraft.

Owner:PAYPAL INC

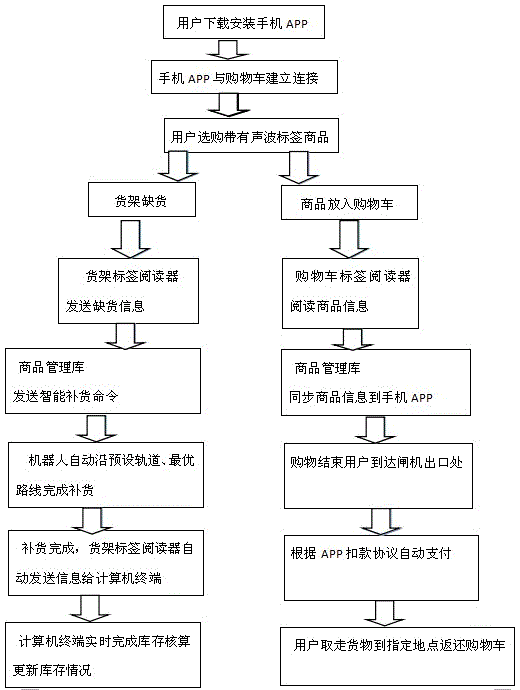

Supermarket shopping system and method based on sonic label technology

InactiveCN106097049AIncrease stickinessIncrease loyaltyCo-operative working arrangementsPayment architectureDatabase analysisPayment

The invention provides a supermarket shopping system and method based on a sonic label technology. The system comprises a supermarket goods storehouse management background, an automatic replenishment robot, a sonic label 360 degree reader shopping cart and shelf, goods with sonic labels, a computer terminal in wireless communication with the shopping cart with the label reader, a mobile phone in network connection with the computer terminal, a user shopping habit analysis database connected with the mobile phone and another computer, a cloud platform, a user APP accumulation credit library, a credit line pre-loan system, and an automatic opening and closing gate. According to the invention, goods unique code information reading and automatic robot replenishment for out-of-stock shelves are realized; simultaneous reading of the reader is not affected by overlapping stacking of goods put into the shopping cart; shopping code, amount and total amount are simultaneously displayed on a mobile phone APP; the mobile phone APP can be fixed with a bank card, or an APP credit blank note is used for overdraft payment; after payment, a gate carries out automatic identification and opening for releasing; a user database analyzes user purchase habits and many other preferred functions; and the system and method have the advantages of simple structure, reasonable design and easy manufacture.

Owner:安徽省凯乐唯物联科技有限公司

Method for minimizing overdraft charge-off

InactiveUS20090327123A1Minimizing overdraft charge-offFinancePayment architectureBank accountData element

A method for minimizing overdraft charge-off in a bank account includes:(a) identifying a plurality of factors that can result in a bank account charge-off;(b) building a case history database of bank account holder information based upon a plurality of data elements associated with each of the plurality of factors;(c) creating numeric and / or categorical representations of the bank account holder information for each of the bank accounts in the case history database;(d) tabulating the numeric and / or categorical representations and the data elements for the bank accounts in the case history database;(e) combining certain ones of the numeric and / or categorical representations to separate the bank accounts in the case history database into a plurality of risk groups, each risk group having an associated probability of charge-off; and(f) optimizing, for each of the plurality of risk groups, a bank profit, by setting overdraft limits.

Owner:CARREKER CORORATION A DELAWARE

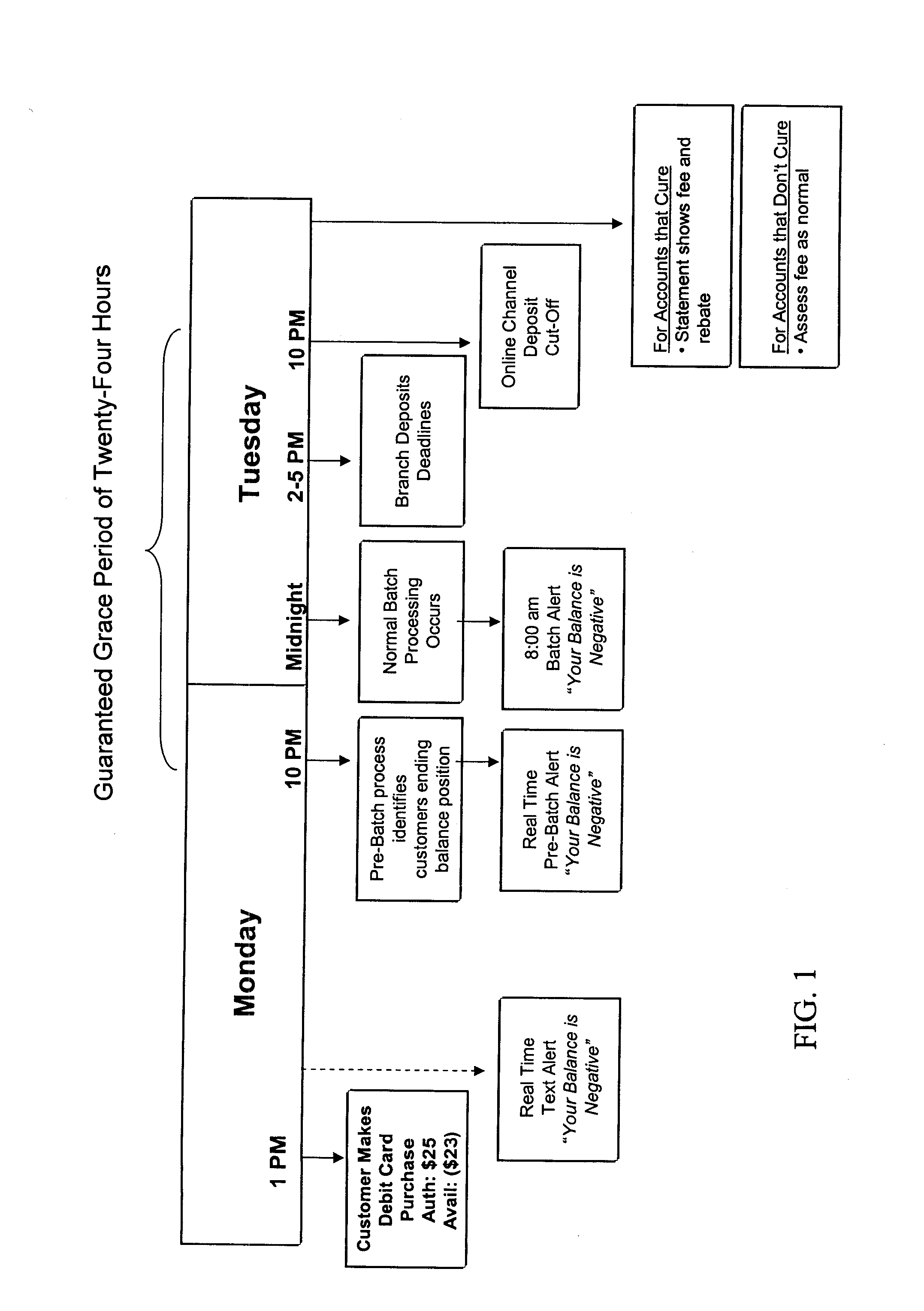

System and method for providing time to cure negative balances in financial accounts while encouraging rapid curing of those balances to a positive net position

A computer implemented method and system for providing financial services are described. The system and method include determining an account balance for a financial account. If the account balance is negative, notice of the negative balance is sent to the account holder in real time. After a predetermined period of time or grace period, and / or by a predetermined end time or cut-off date or time, it is determined whether the negative balance was cured. If the negative balance was not cured during the grace period, an overdraft fee is assessed to the financial account. If the negative balance was cured during the grace period, any assessed overdraft fee for the negative balance is rebated or reversed.

Owner:HUNTINGTON BANCSHARES

Methods and systems for accepting offers via checks

In accordance with one or more embodiments, a method and system are provided for facilitating the output of an offer to an account holder of a financial account, which offer the account holder may accept via a check being presented by the account holder as payment for a transaction. For example, the account holder may alter an indicium on the check to indicate acceptance of the offer. An example of an offer is an offer to sell to the account holder transactional overdraft protection for the transaction for which a check is provided as payment. Another example of an offer to provide a benefit to the account holder in exchange for a commitment by the account holder to an obligation. Such an offer may be provided by, for example, a merchant different than the merchant at which the check is being provided as payment for a transaction. In one or more embodiments, the offer or an indication of the offer may be printed on the check or handwritten on the check.

Owner:PAYPAL INC

Consumer-based system and method for managing and paying electronic billing statements

InactiveUS20050065883A1Minimizing overdraftMinimizes overdraftFinanceDigital computer detailsPayment scheduleGraphics

A consumer-based bill management and payment system is configured to receive, analyze, manage and pay electronic billing statements received from the biller over the Internet. The system includes a notification manager that detects when the electronic bill arrives and notifies the consumer. The bill is stored in memory with other unpaid electronic bills. According to another aspect of the invention, the system has a cashflow analyzer that enables the consumer to coordinate the unpaid electronic bills according to different payment schedules for a bill payment cycle (e.g., a month). The goal of the manipulation is to permit the consumer to analyze how the different payment schedules affect the consumer's cashflow with an aim toward minimizing overdraft during the bill payment cycle. The cashflow analyzer can automatically compute an optimized payment schedule that minimizes overdraft of the consumer's account, while maximizing the balance to generate the most interest. When the consumer desires to pay a particular bill, the bill is presented to the consumer through a graphical user interface (UI). The bill management and payment system supports a payment analyzer to enable the consumer to determine how much of the electronic bill to pay. The payment analyzer provides a venue to challenge certain items on the bill.

Owner:MICROSOFT TECH LICENSING LLC

Remote and real-time charge control management system and method

InactiveCN106204931AAccurate creditGood electricity experienceData processing applicationsApparatus for hiring articlesReal-time chargingTime limit

The invention discloses a remote and real-time charge control management system and method. An electricity utilization information acquisition module acquires electricity utilization information of a user electricity meter in real time, and a data concentrator module stores at least 31 daily zero-frozen electric energy data and 12 month-end-frozen electric energy data of each customer electric energy meter; a charge calculation module stores payment history data of user accounts, a customer information grouping and modeling unit deep mines electricity utilization characteristics of the users, divides the users into different customer groups by combining data mining and gives different payment time limiting days and overdraft electric charge limit values which correspond to the characteristics according to the characteristics of the customer groups. According to the remote and real-time charge control management system and method, real-time and precise charge analysis is provided for the users, an electricity marketing department can conveniently extract and integrate the user information, grade the users and conduct fine management on the users by combining the credit line, and user experience is promoted.

Owner:JINAN LICHENG POWER SUPPLY CO OF STATE GRID SHANDONG ELECTRIC POWER CO +1

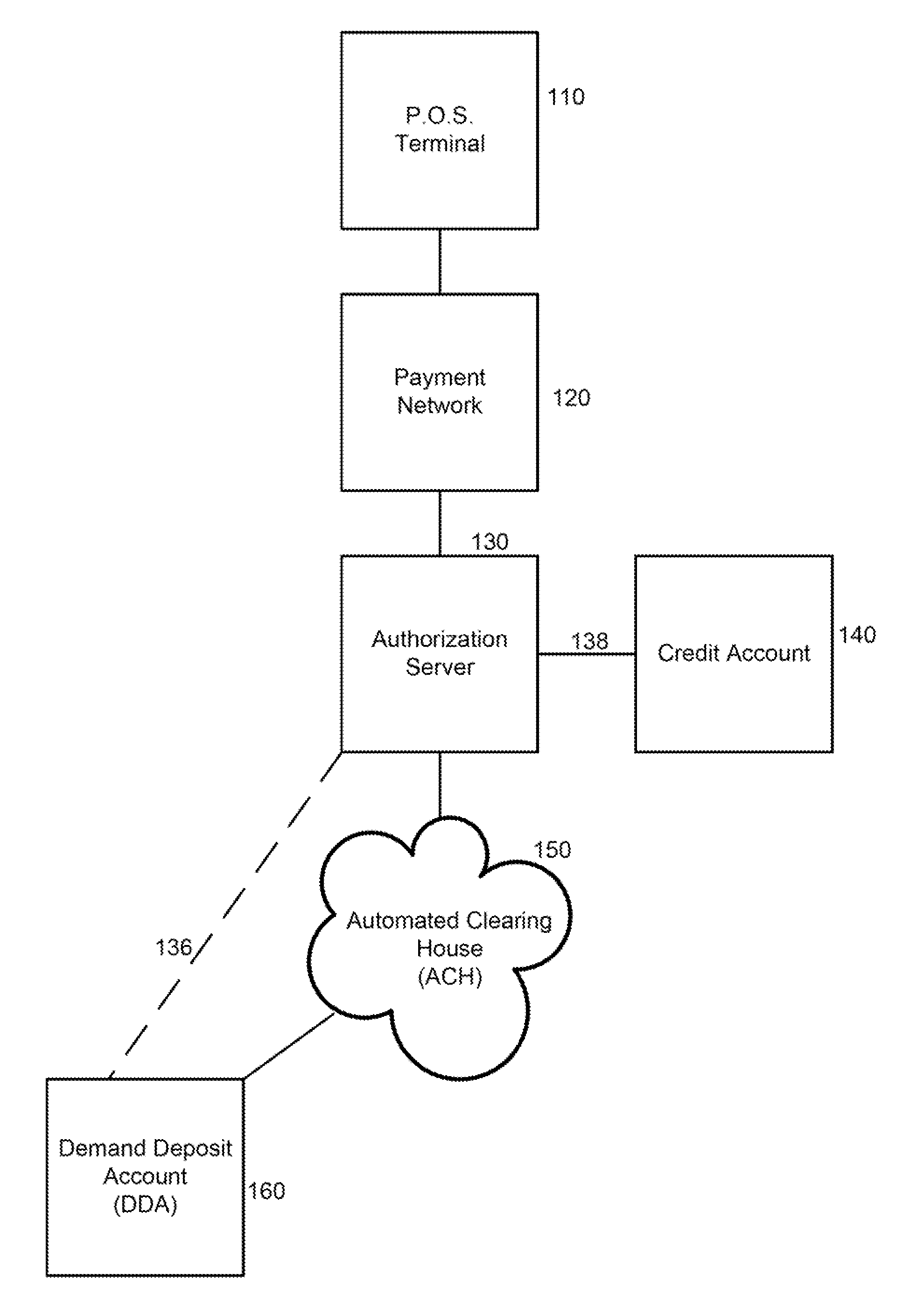

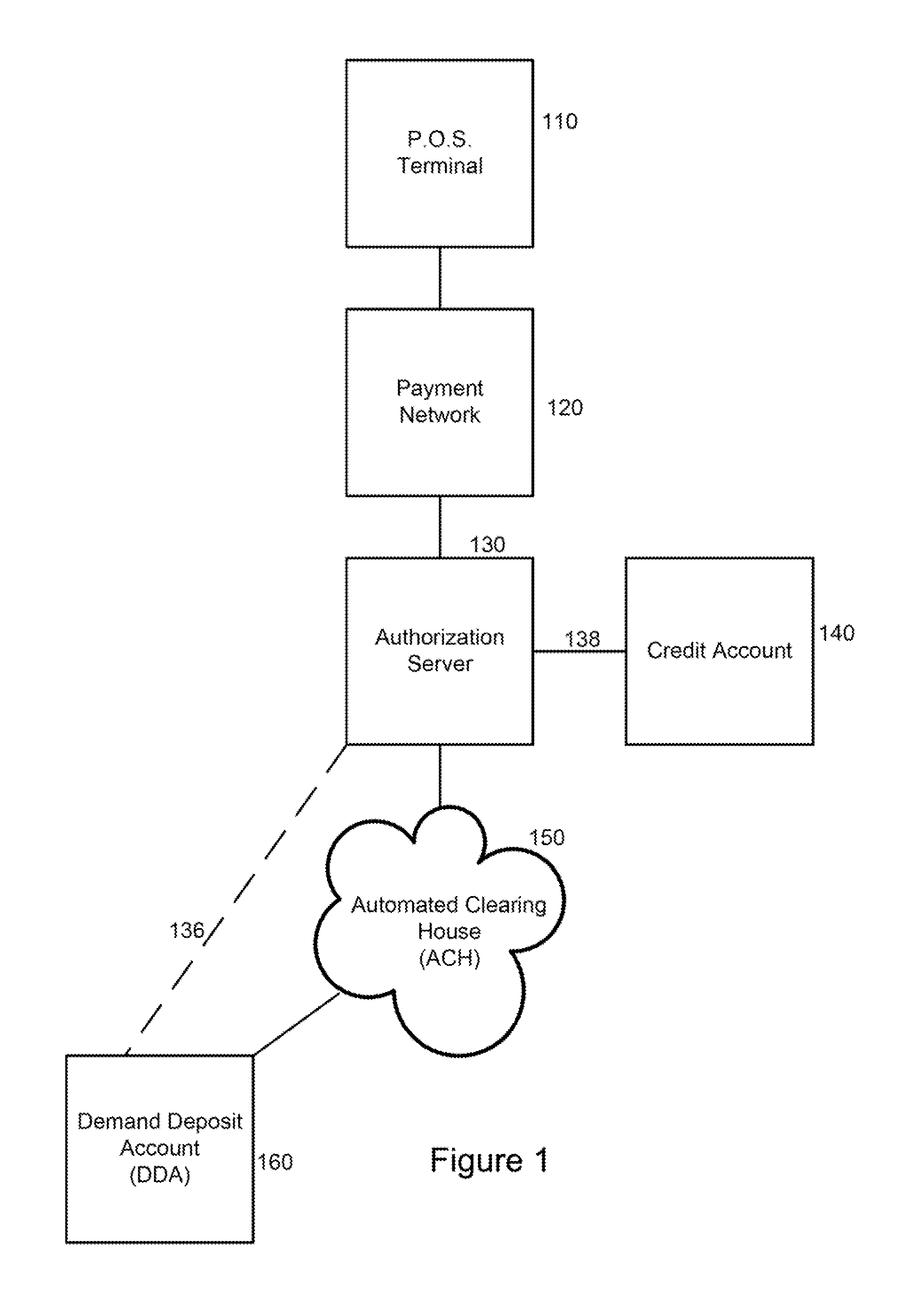

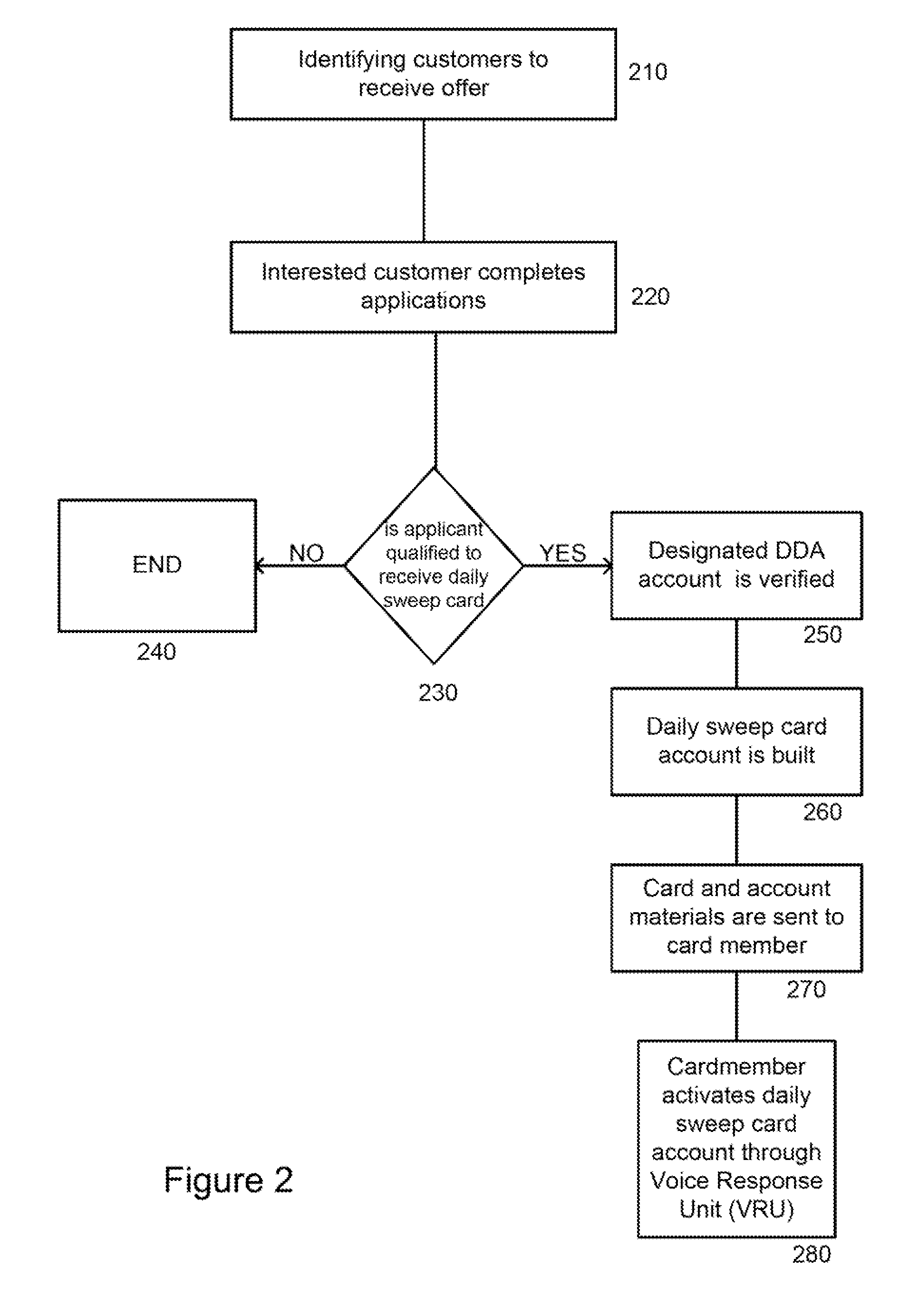

System and Method for Linked Account Having Sweep Feature

Owner:JPMORGAN CHASE BANK NA

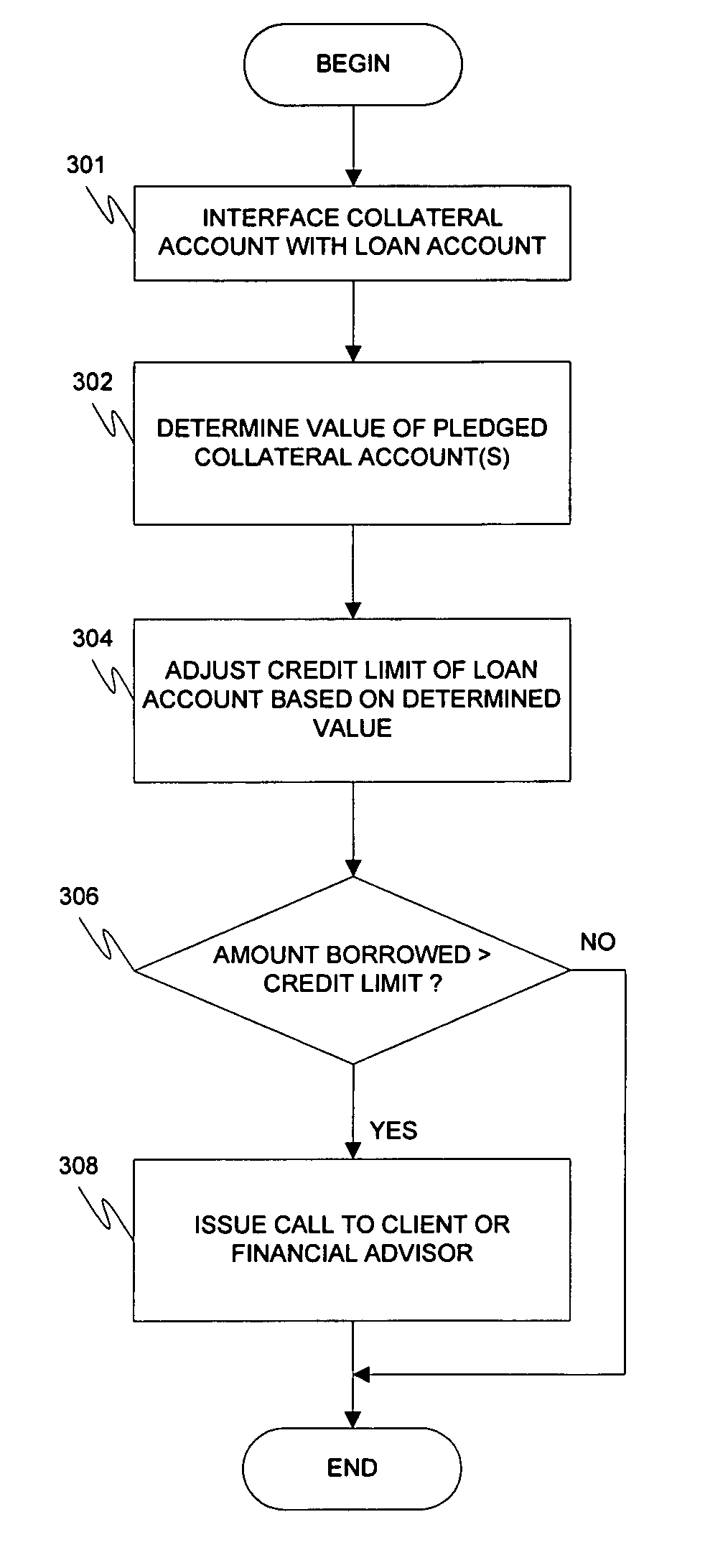

Loan management account

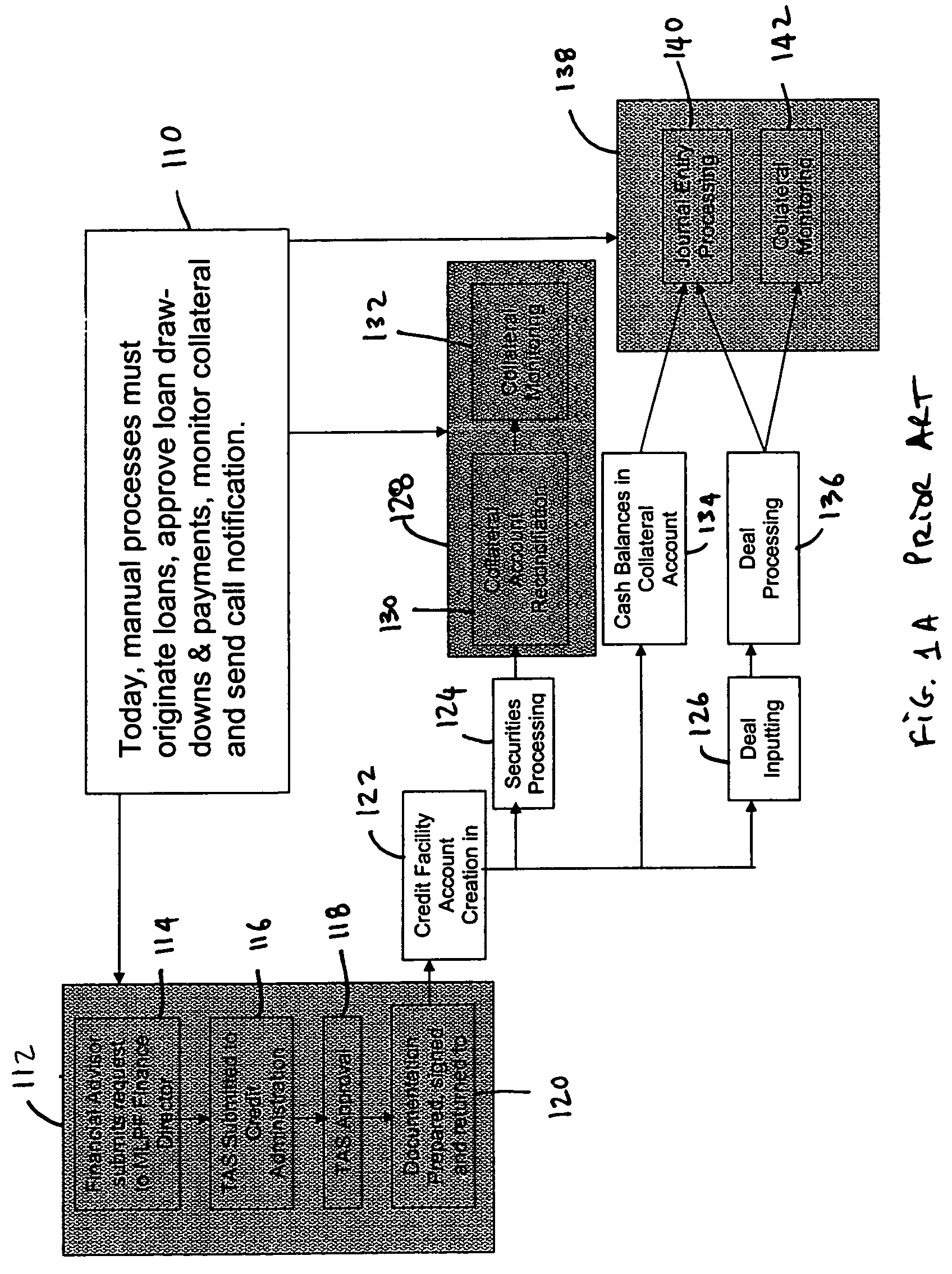

One or more brokerage collateral accounts held at a financial institution are provided. A bank loan account secured by at least one of the collateral accounts with the financial institution is established. The bank loan account interfaces with the collateral accounts within the financial institution. The bank loan account has a credit limit that is based on a market value of the secured collateral accounts. The collateral accounts include various types of assets. The loan account includes a revolving line of credit, any number of term loans, or letters of credit. The interest rate of the line of credit may be based on a selected index rate. Further, the loan account may be used as an overdraft account for the secured collateral account. Clients may access both their collateral accounts and their loan account through the brokerage infrastructure including an integrated portal with a network of computers or via telephone.

Owner:BANK OF AMERICA CORP

Method and device for realizing overdraft in pre-payment service

InactiveCN1921534AIncrease popularityMeet special needsPrepayment telephone systemsPaymentCharge control

The invention relates to a method for realizing overdraft in prepayment service, used to overdraft the user whose left sum is not enough in the prepayment charging system. Wherein, said prepayment charging system comprises charging point, charging server and charging control point; said method comprises that the prepayment user triggers the prepayment charging request; the charging control point detects that the left sum is not enough, and finds the prepayment user is the one able to overdraft; if it is, allowing said user to overdraft; or else, forbidding it to overdraft. The invention also discloses a relative device.

Owner:HUAWEI TECH CO LTD

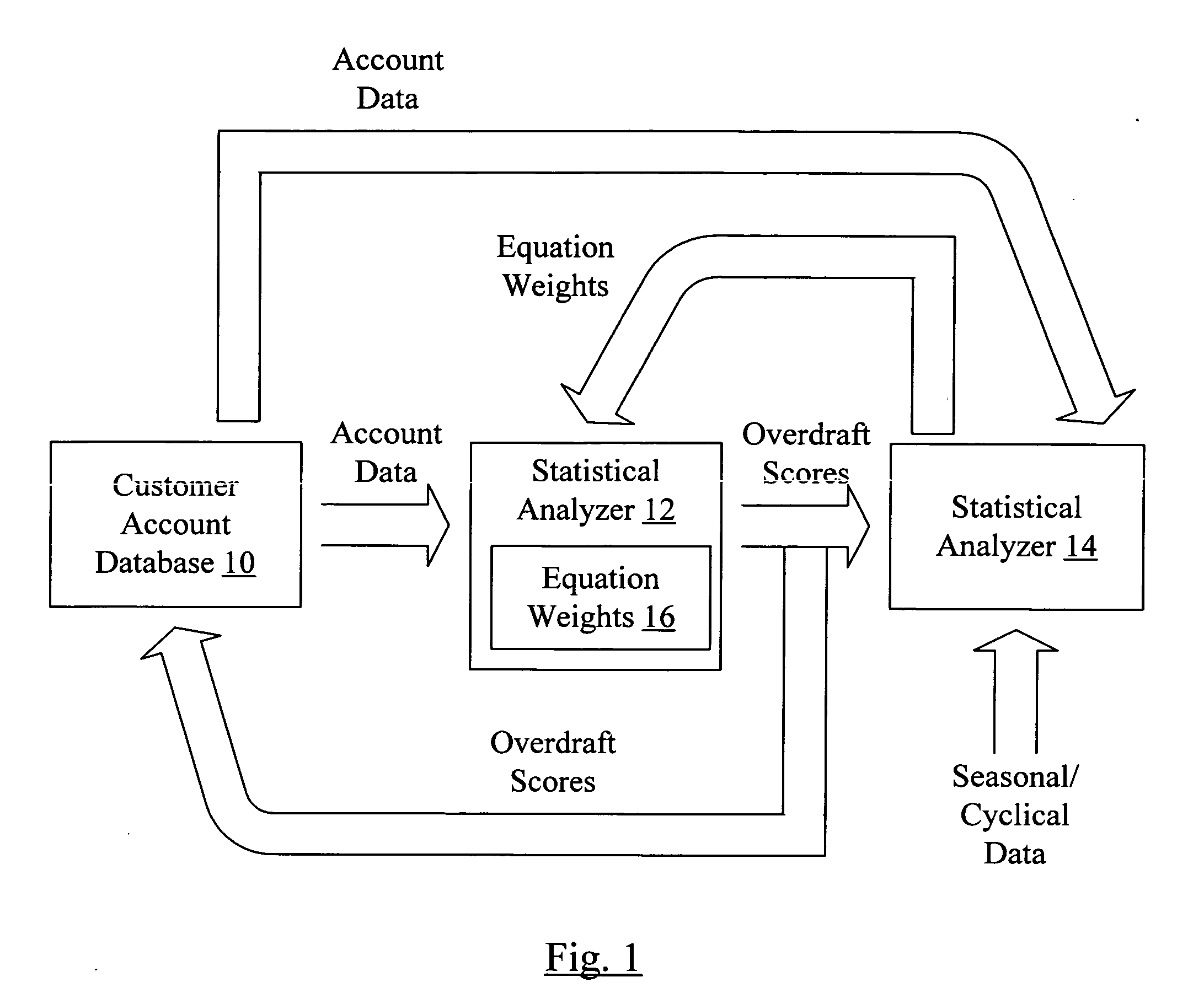

Method for enhancing revenue and minimizing charge-off loss for financial institutions

In one embodiment, a computer accessible medium stores a plurality of instructions which, when executed: (i) statistically analyze account data corresponding to a plurality of accounts at a financial institution to determine which account data items are most strongly correlated to a charge-off event in an account (and / or a fee revenue event, in some embodiments); (ii) generate one or more factors for one or more equations corresponding to the plurality of accounts, the one or more factors weighting the account data items according to relative correlation to the charge-off event; and (ii) evaluate the one or more equations for the plurality of accounts and establish an account feature for each of the plurality of accounts responsive to the evaluation. For example, the account feature may be the overdraft limit.

Owner:SHESHUNOFF MANAGEMENT SERVICES LP

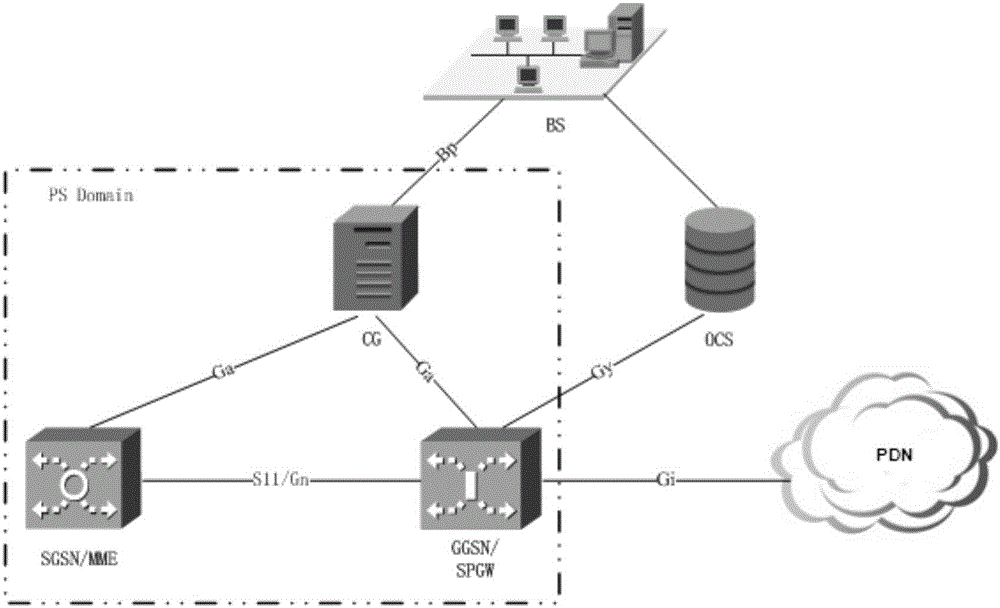

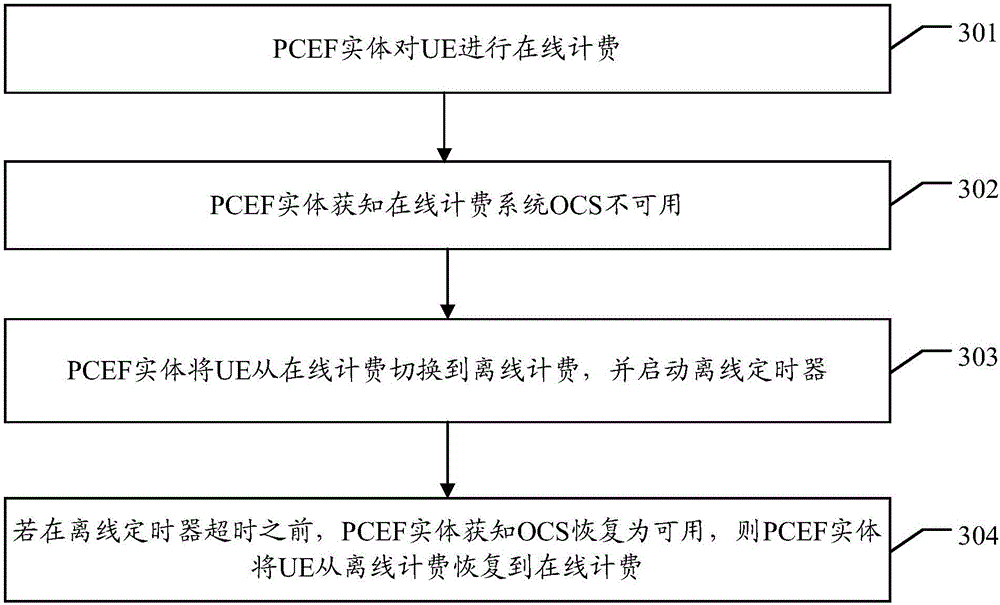

Charging method, network device, and charging system

ActiveCN106465084AImprove experienceReduce the risk of overdraftAccounting/billing servicesTelephonic communicationOnline charging systemTimer

Disclosed are a charging method, a network device and a system, for use in recovering an online charging function in time when an OCS is faulty, thereby reducing risks of user account overdraft, and improving user experience. The method in an embodiment of the present invention comprises: a PCEF entity performs online charging on a UE; when it is known that an online charging system (OCS) is unavailable, the PCEF entity switches the UE from online charging to offline charging, and starts an offline timer; and if the PCEF entity knows, before the offline timer times out, that the OCS is recovered to be available, the PCEF entity switches the UE from the offline charging to the online charging. In the solution, after users are switched to offline charging, an online charging function is recovered in time when an OCS is available, thereby reducing possible risks of user account overdraft during an offline charging process; and the solution can avoid deactivating users, thereby improving user experience.

Owner:HUAWEI TECH CO LTD

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com