Medium small and micro-sized enterprise credit system

An enterprise and credit technology, applied in the field of small, medium and micro enterprise credit system, can solve the problems of high loan interest rate, capital gap, and high financing threshold, and achieve the effect of increasing innovation, reliable data and high efficiency

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0021] The content of the present invention is described in more detail below:

[0022] The expression of the present invention is as follows:

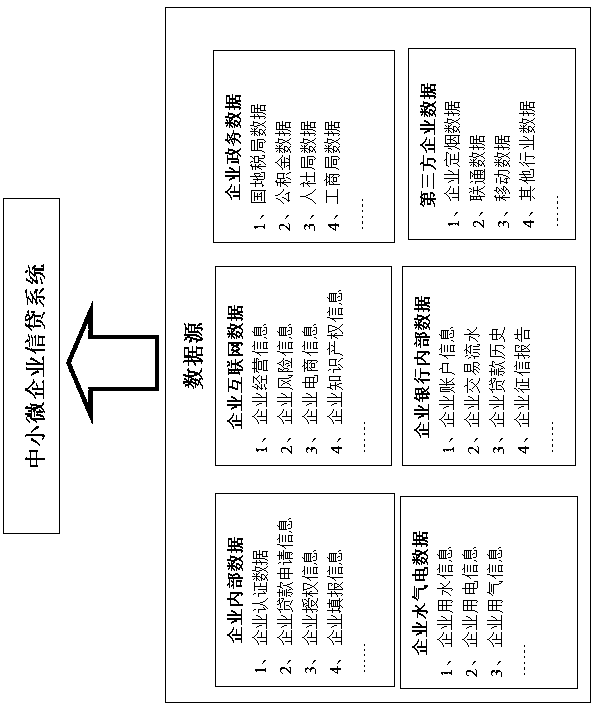

[0023] The data sources of the micro, small and medium-sized enterprise credit system include corporate Internet big data, government affairs data, enterprise internal data, water and electricity data, bank data, and third-party data, see figure 1 .

[0024]Enterprise Internet data includes enterprise operating data (such as bid winning data, bidding data, major project data, stock market information, product data, etc.), enterprise risk information (such as judgment documents, court announcements, court announcements, investment and financing information, movable property pledges, etc.) and enterprise e-commerce data (such as enterprise online store information, online store sales information, etc.); enterprise government affairs data is mainly based on the data requirements of enterprises put forward by various banking and financi...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com