Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

69results about How to "Reduce transaction" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

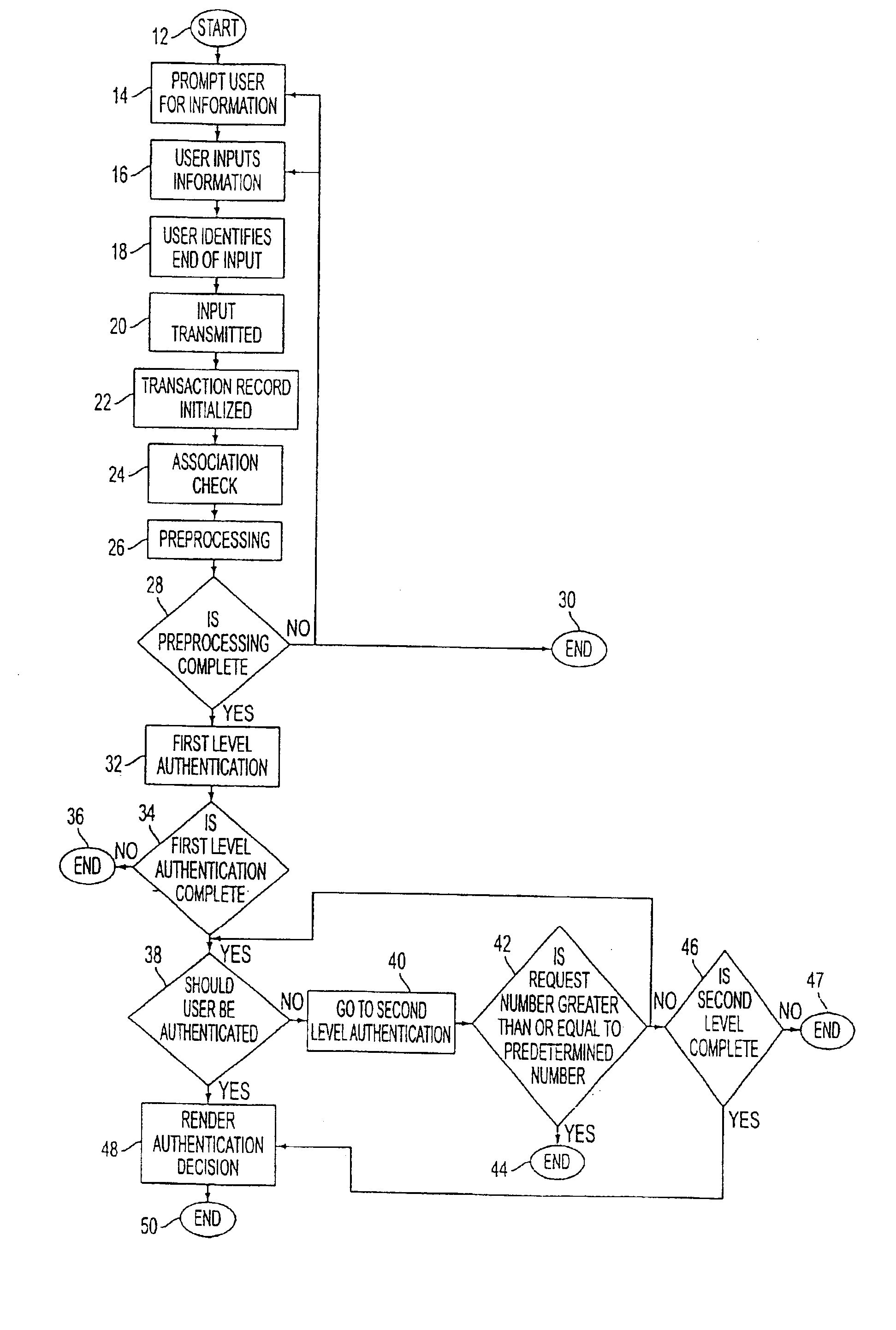

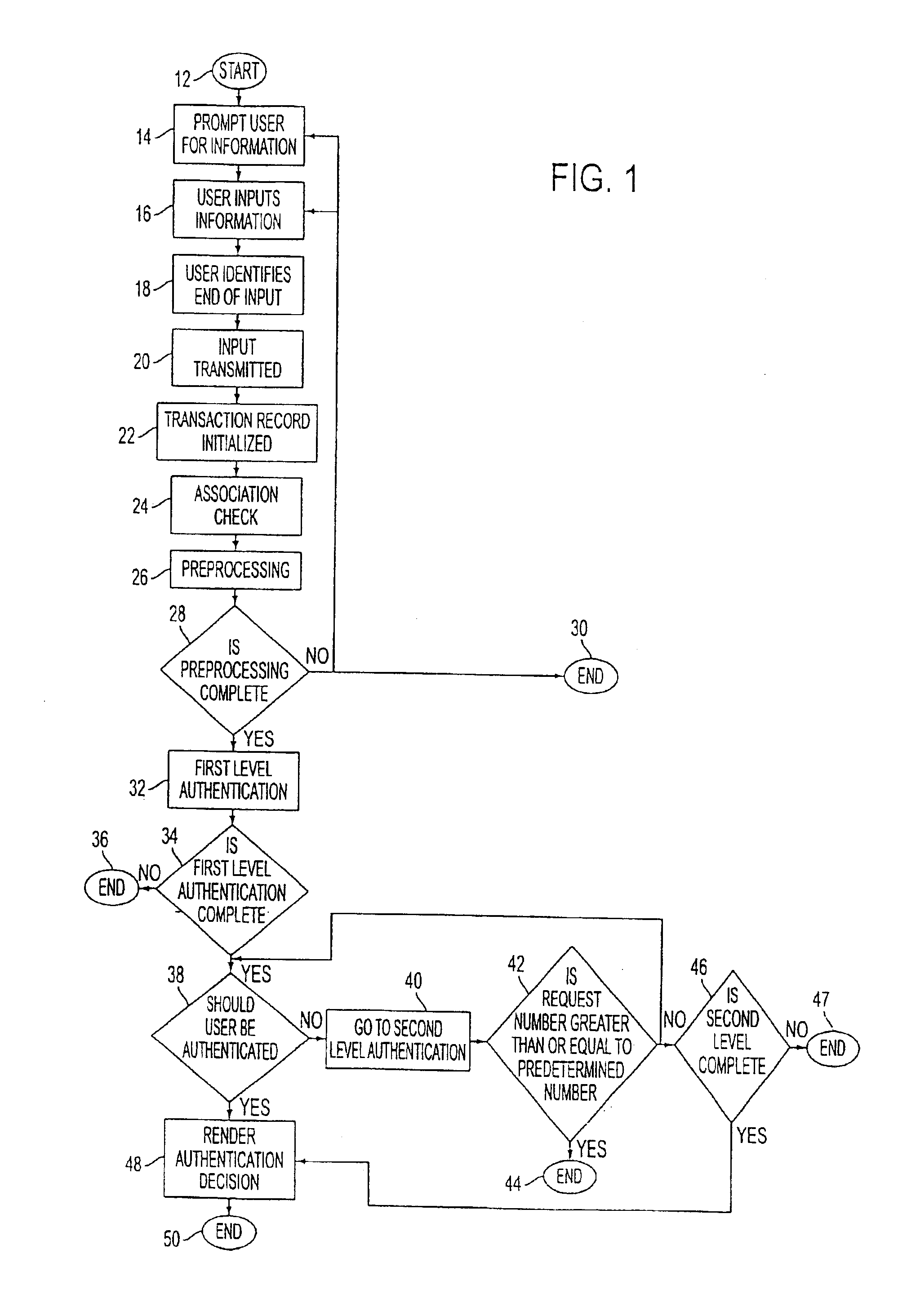

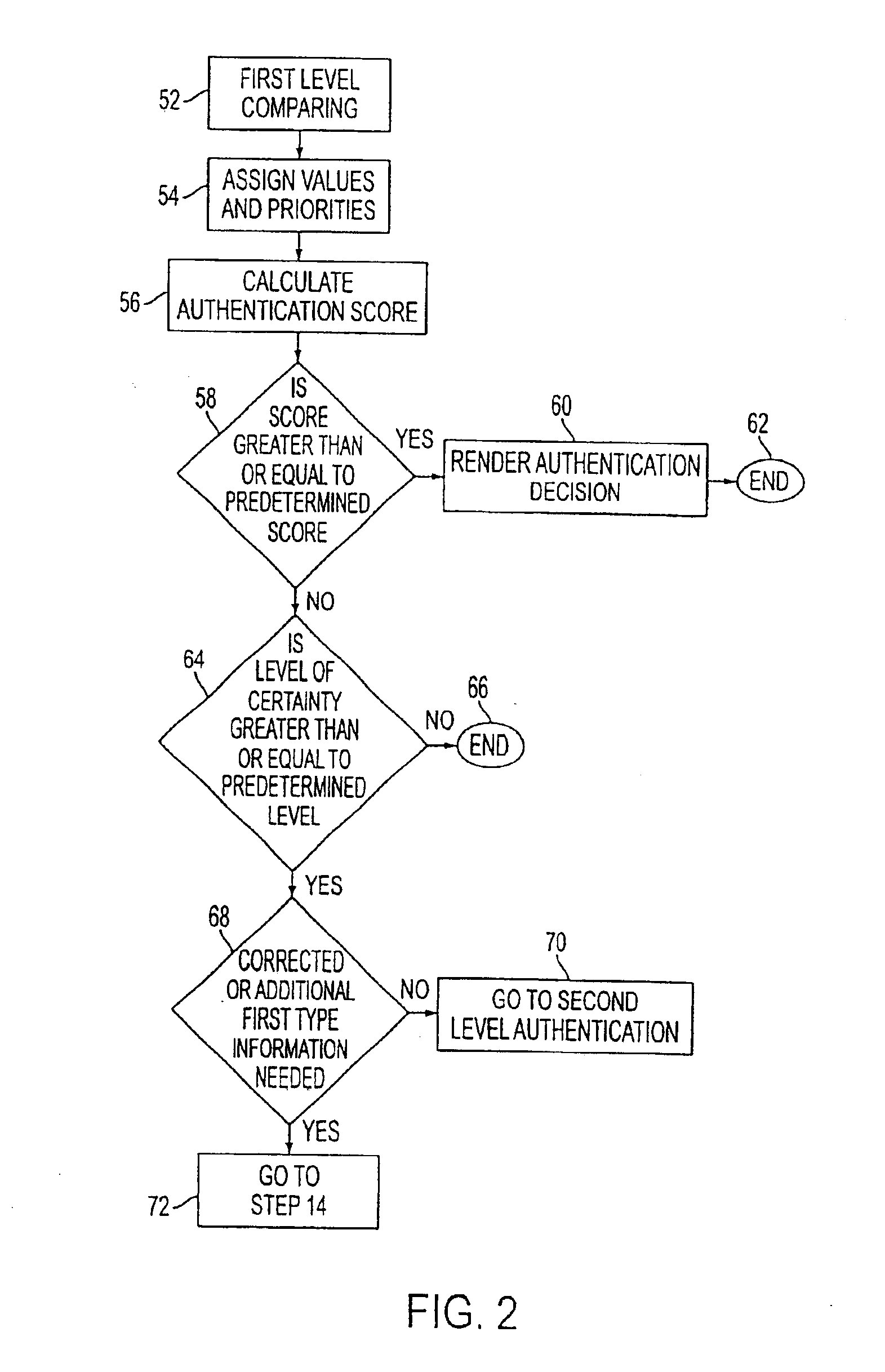

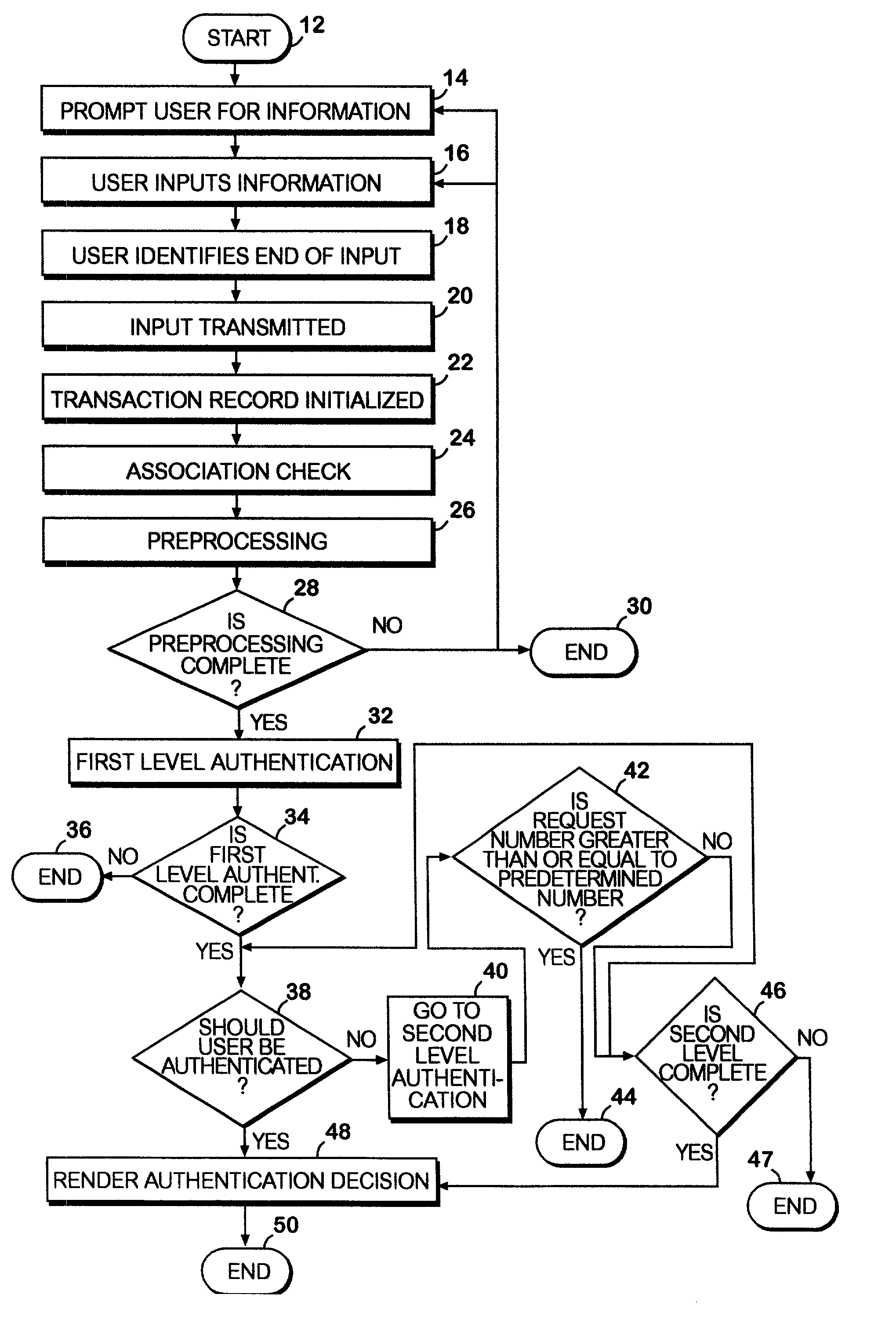

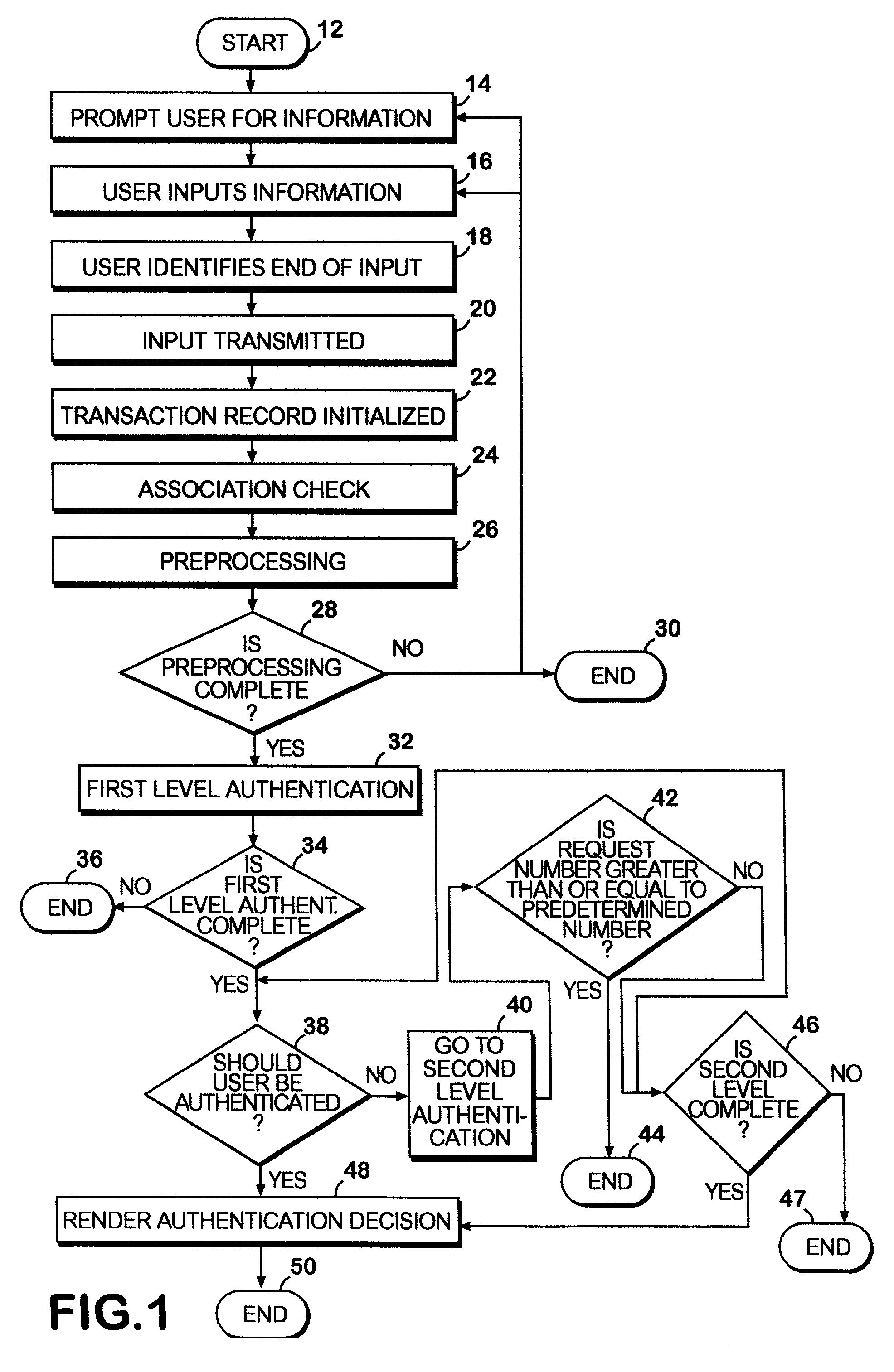

System and method for authentication of network users

InactiveUS6857073B2Avoiding terminationReducing cost and unnecessary useDigital data processing detailsUser identity/authority verificationInternet privacyInformation design

A network authentication system provides verification of the identity or other attributes of a network user to conduct a transaction, access data or avail themselves of other resources. The user is presented with a hierarchy of queries based on wallet-type (basic identification) and non-wallet type (more private) information designed to ensure the identity of the user and prevent fraud, false negatives and other undesirable results. A preprocessing stage may be employed to ensure correct formatting of the input information and clean up routine mistakes (such as missing digits, typos, etc.) that might otherwise halt the transaction. Queries can be presented in interactive, batch processed or other format. The authenticator can be configured to require differing levels of input or award differing levels of authentication according to security criteria.

Owner:EQUIFAX INC

System and method for authentication of network users

InactiveUS7234156B2Reducing cost and unnecessary useChanceDigital data processing detailsUser identity/authority verificationBatch processingInformation design

A network authentication system provides verification of the identity or other attributes of a network user to conduct a transaction, access data or avail themselves of other resources. The user is presented with a hierarchy of queries based on wallet-type (basic identification) and non-wallet type (more private) information designed to ensure the identity of the user and prevent fraud, false negatives and other undesirable results. A preprocessing stage may be employed to ensure correct formatting of the input information and clean up routine mistakes (such as missing digits, typos, etc.) that might otherwise halt the transaction. Queries can be presented in interactive, batch processed or other format. The authenticator can be configured to require differing levels of input or award differing levels of authentication according to security criteria.

Owner:EQUIFAX INC

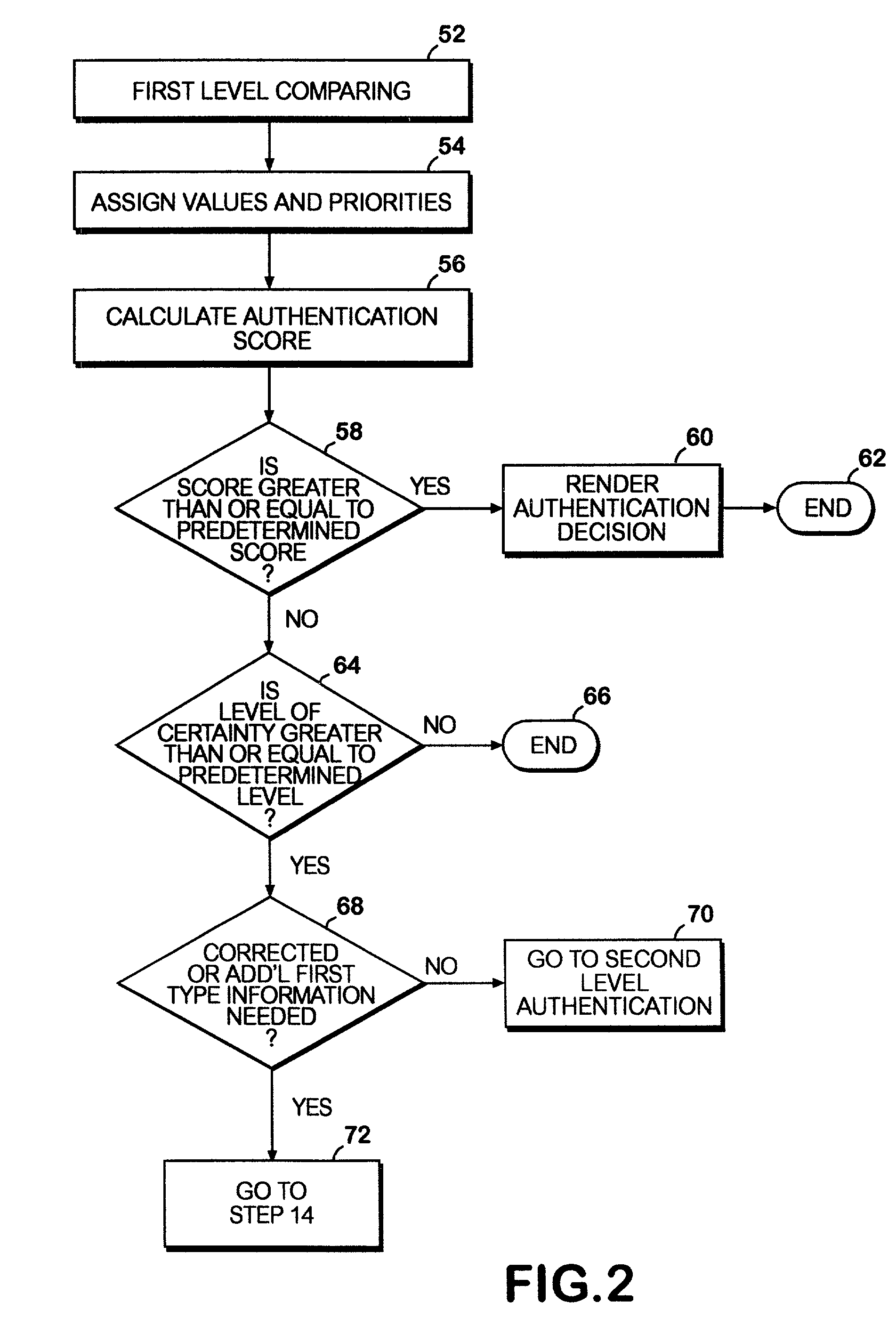

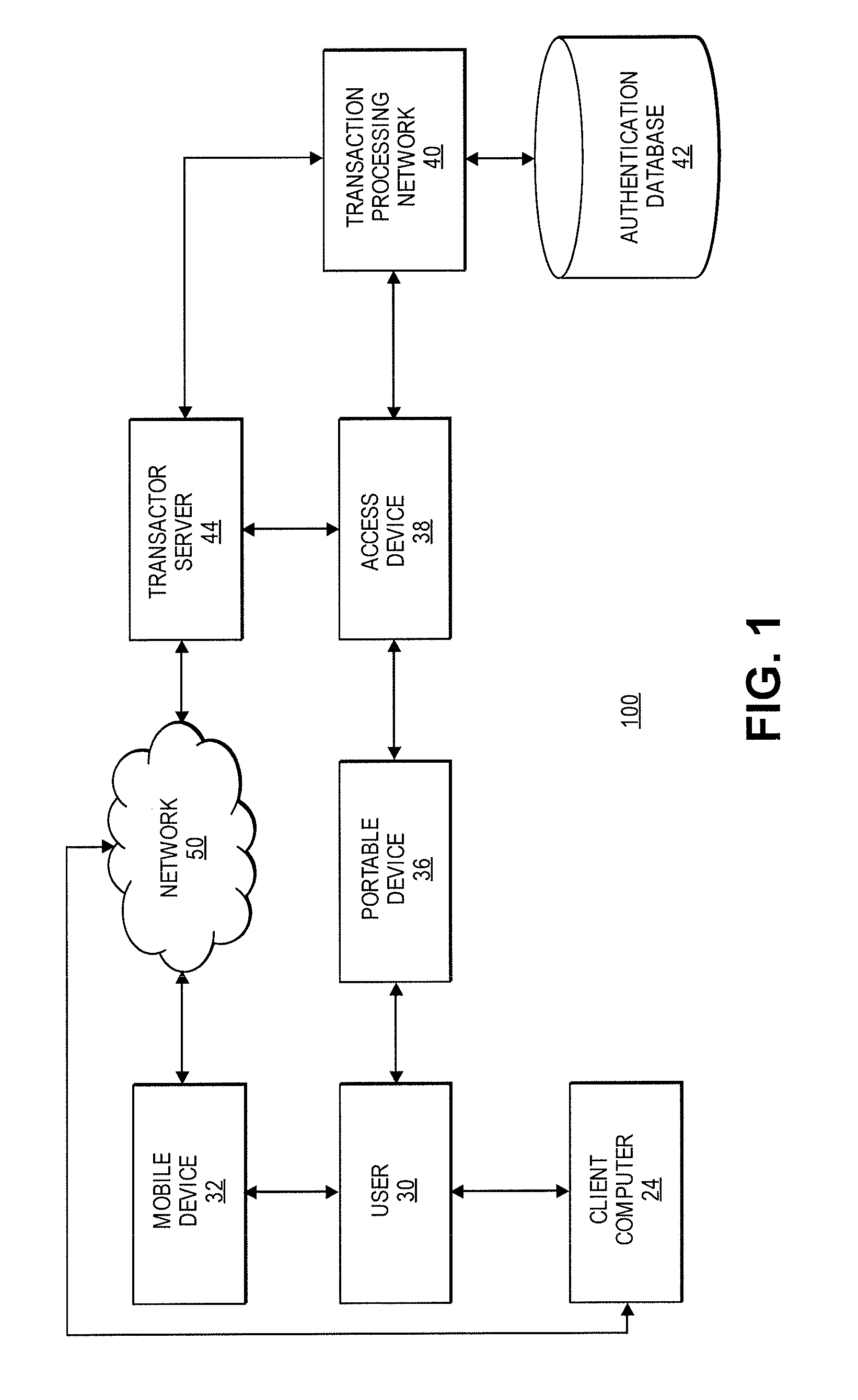

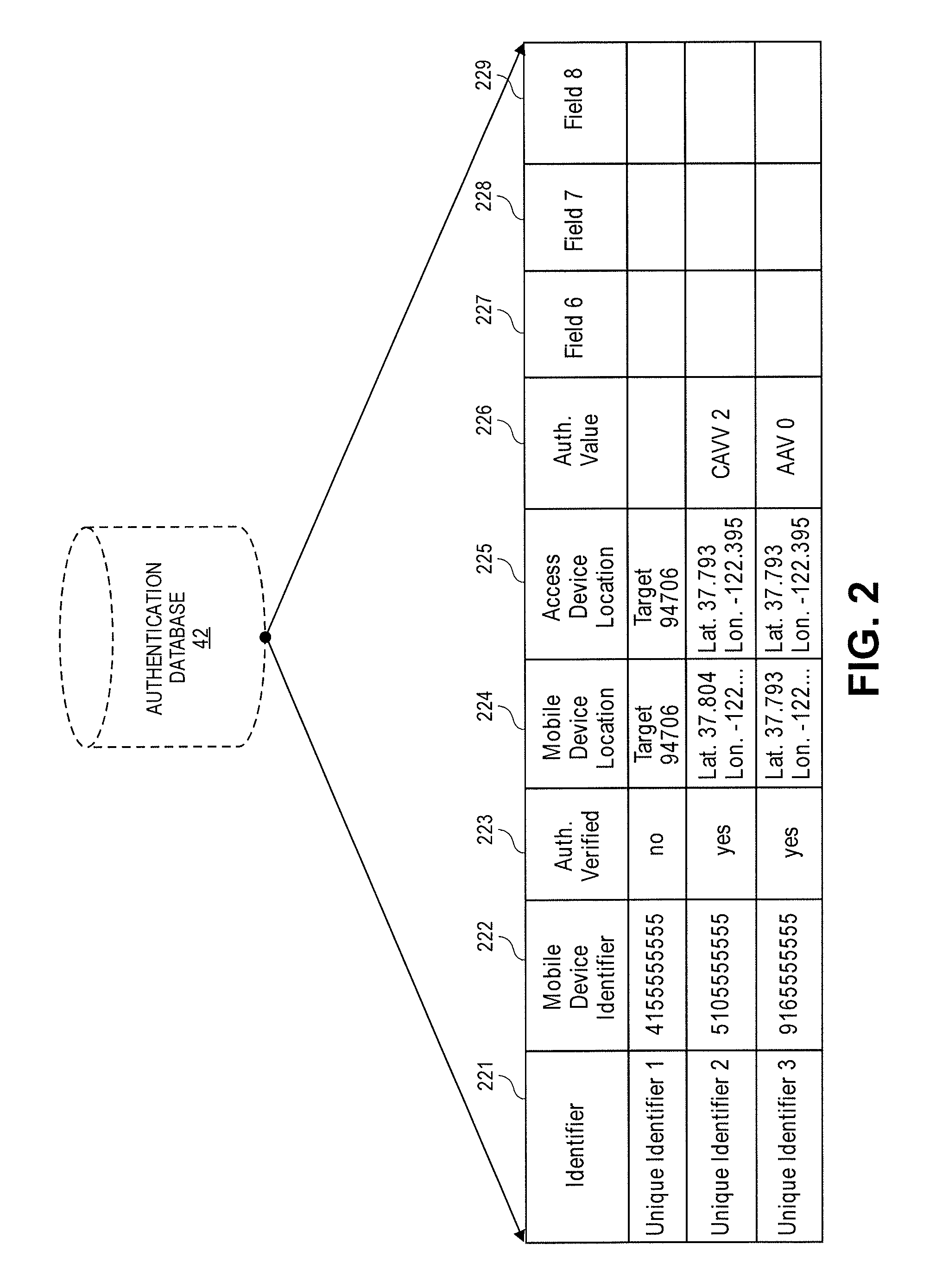

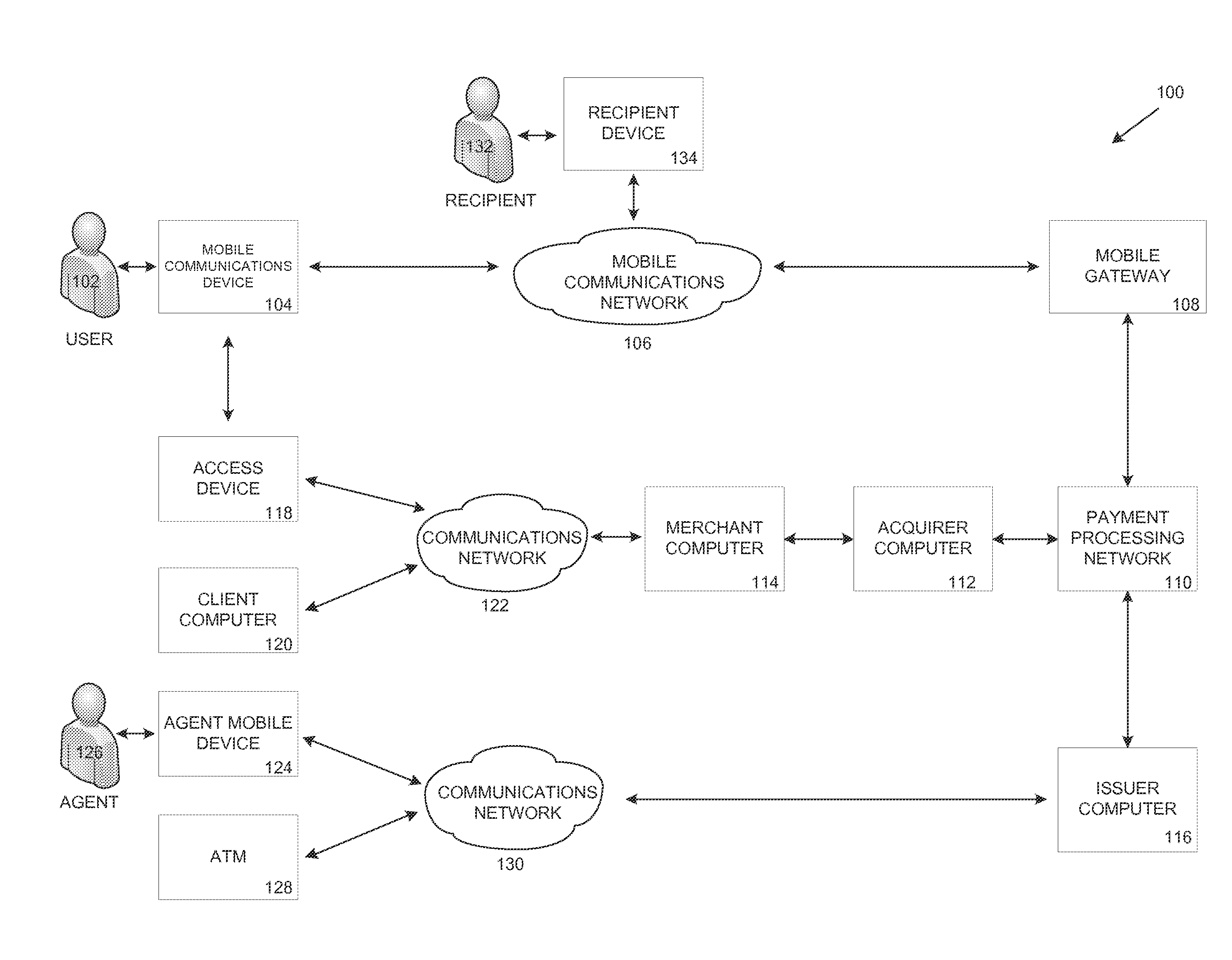

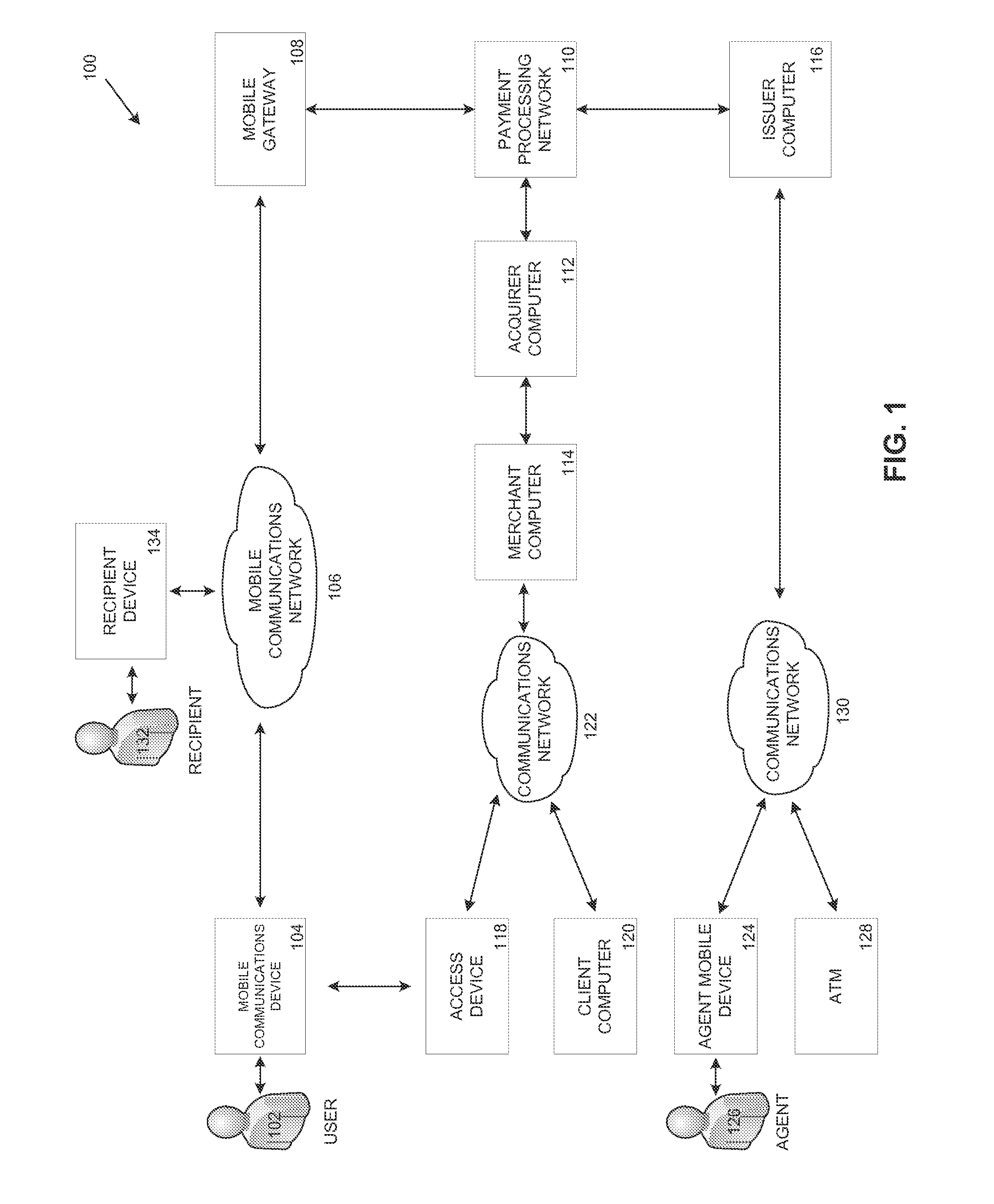

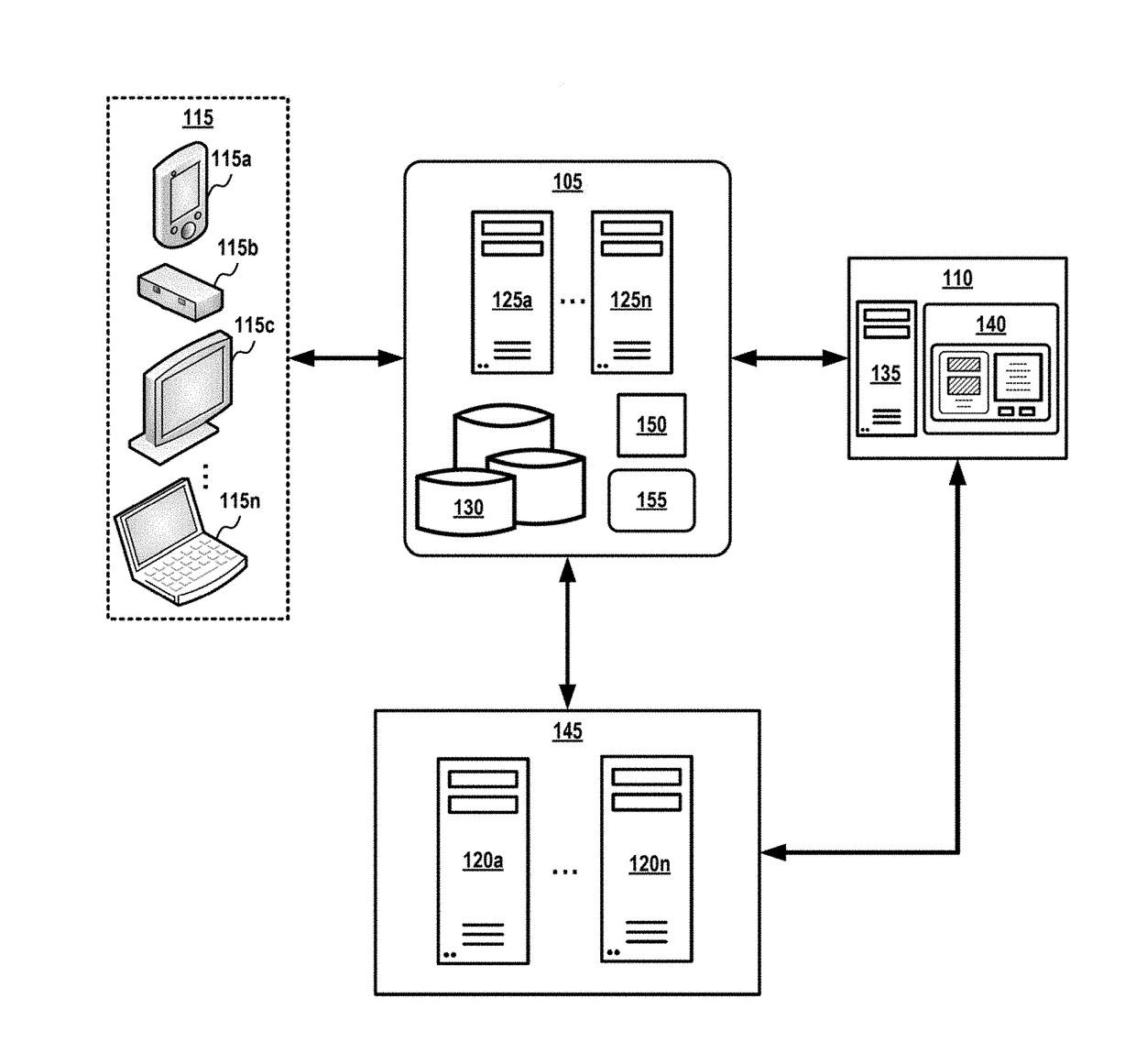

Data verification using access device

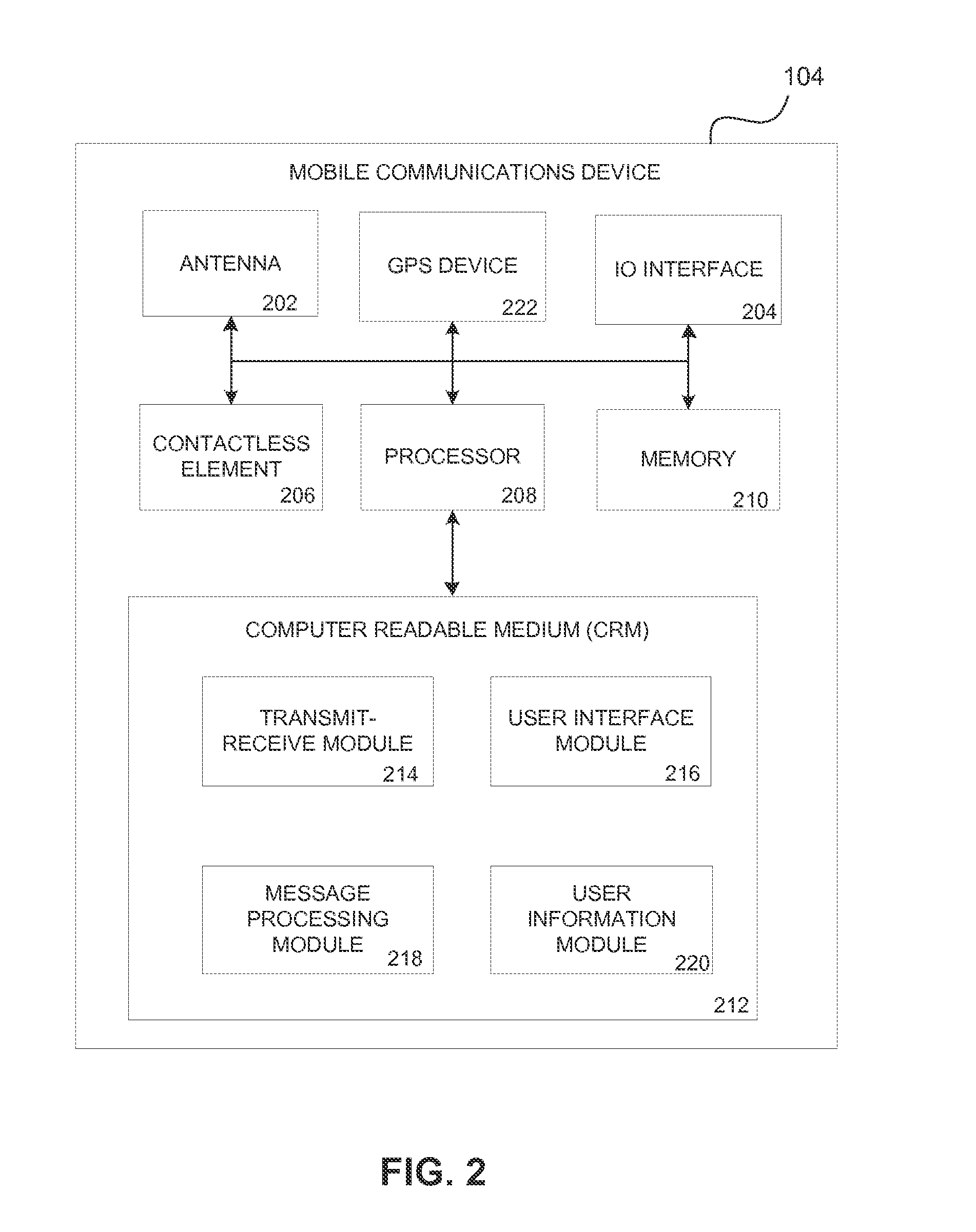

ActiveUS9680942B2Reduce transactionDigital data processing detailsLocation information based serviceTransaction dataMobile device

An embodiment of the invention is directed to a method comprising receiving, at a server computer, information for a portable device that includes a mobile device identifier and storing, by the server computer, the information for the portable device that includes the mobile device identifier in a database associated with the server computer. The method further comprising receiving, by the server computer, transaction data from an access device for a transaction conducted at the access device, determining, by the server computer, from the transaction data that the transaction is associated with the portable device, determining, by the server computer, a location of the access device, determining, by the server computer, a location of a mobile device associated with the mobile device identifier, determining, by the server computer, that the location of the mobile device matches the location of the access device, and marking, by the server computer, the stored information for the portable device as authentication verified.

Owner:VISA INT SERVICE ASSOC

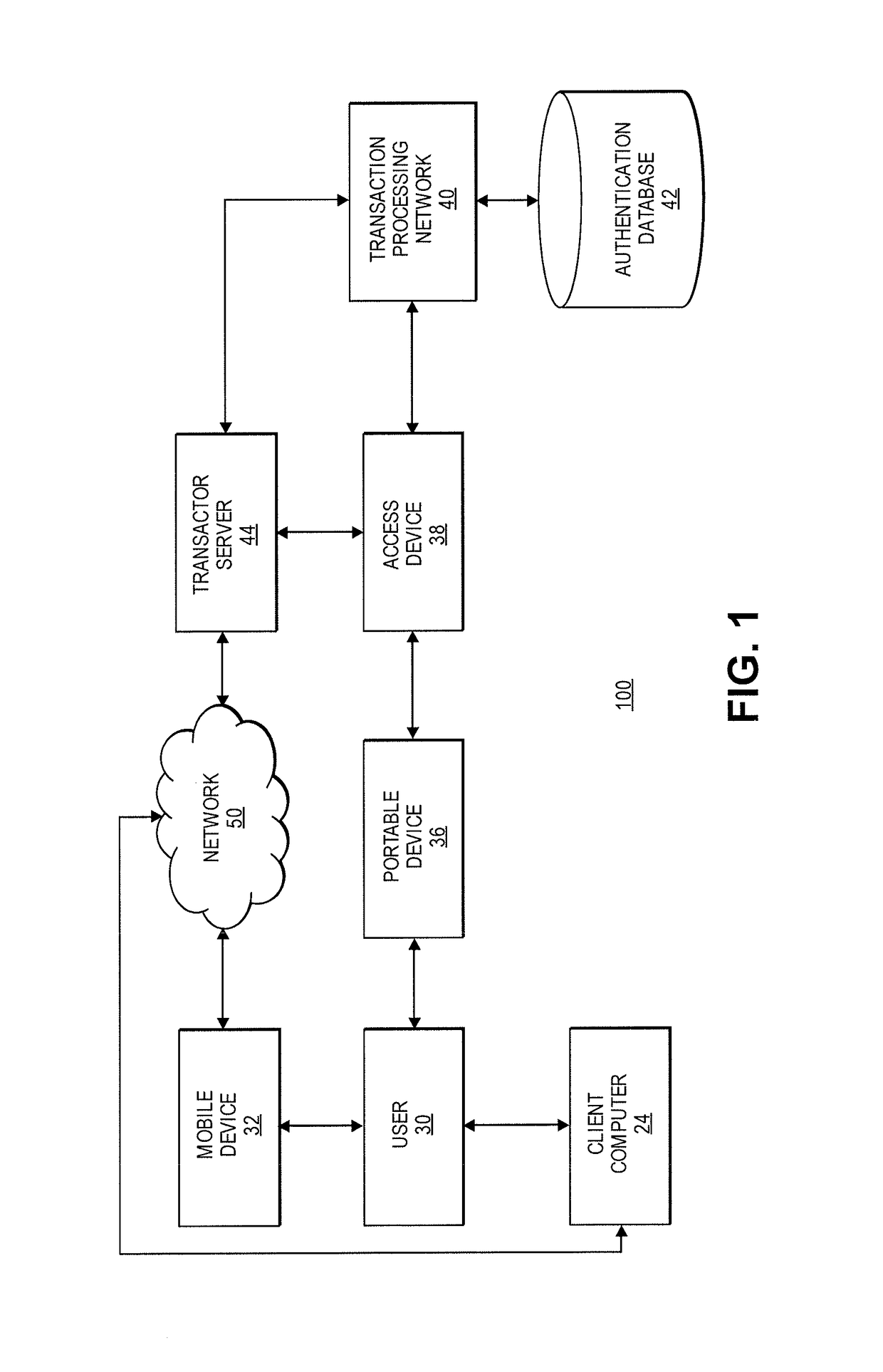

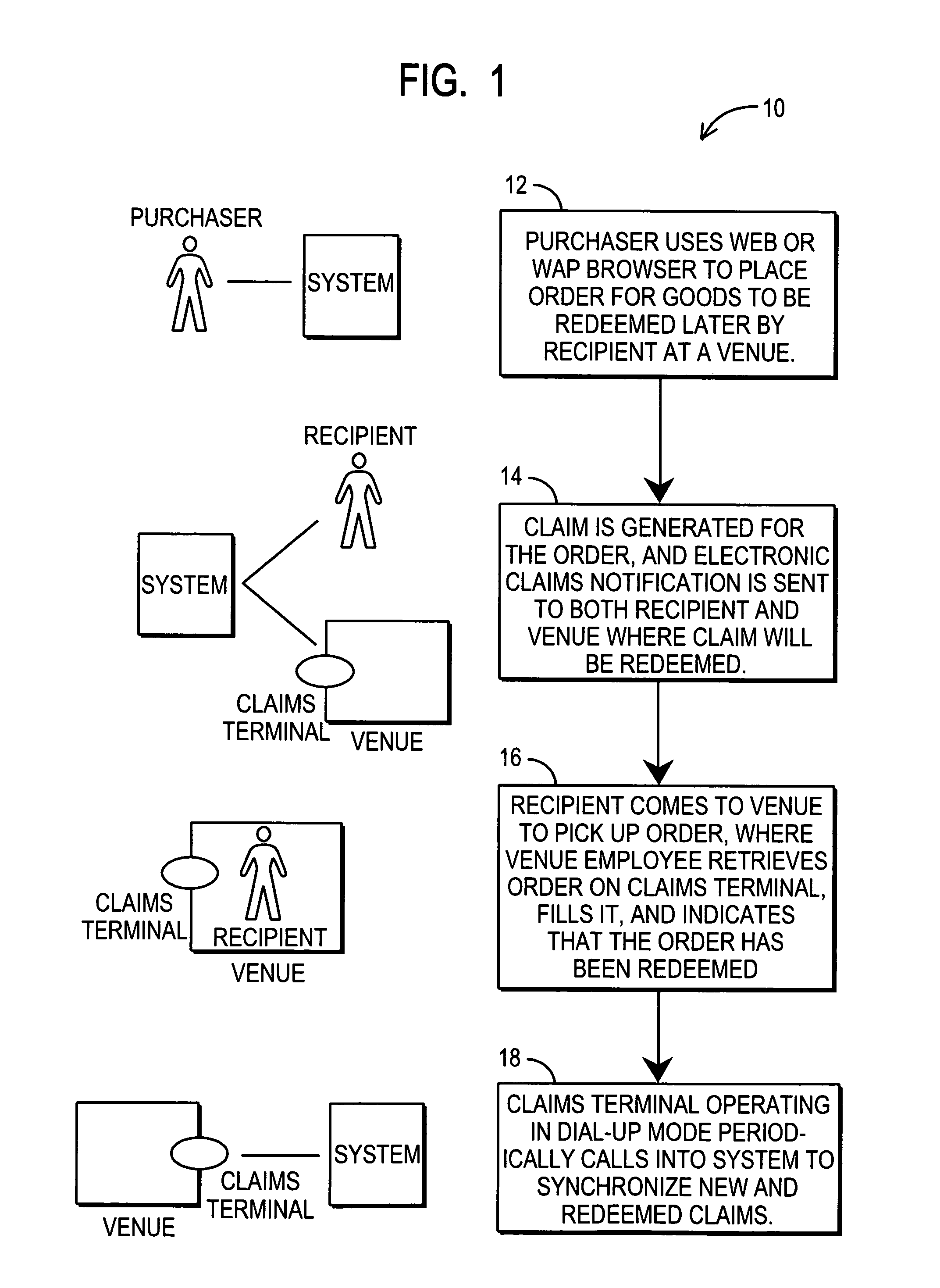

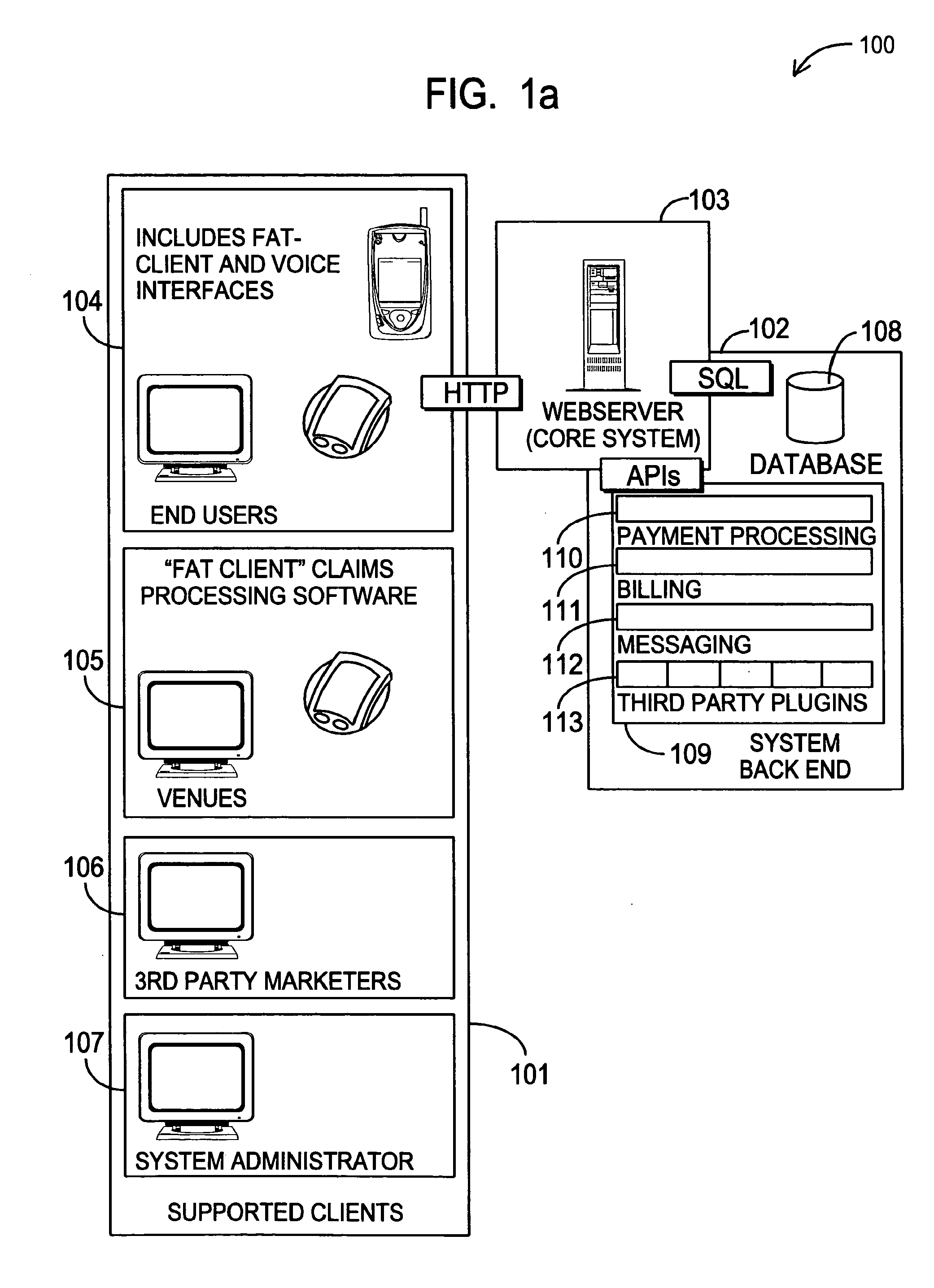

Remote purchasing system, method and program

ActiveUS7496527B2Increasing branding opportunityReduce riskCredit schemesBuying/selling/leasing transactionsPersonalizationThird party

The present invention discloses a system and method for enabling the remote purchasing of products or services, etc. (e.g., alcoholic beverages) wherein, as part of the buying transaction, the purchaser indicates a specific physical location where the product will be claimed, may identify a third party as the “recipient” of the product by providing the third-party's e-mail or text messaging address, can attach a personalized message to the transaction, and can specify the information required for recipients who are already known to the system to make an expedited return purchase in real or near-real time. In one aspect, a method of facilitating a third-party purchase includes the steps of receiving, via a first communications device, an instruction from a purchaser to purchase at least one product or service for a prospective recipient at a venue designated to provide that product or service to the recipient in person, the instruction comprising data identifying at least the recipient, the product or service, and the venue; and sending to the venue, via a second communications device, data identifying at least the recipient and the product or service.

Owner:GULA CONSULTING LLC

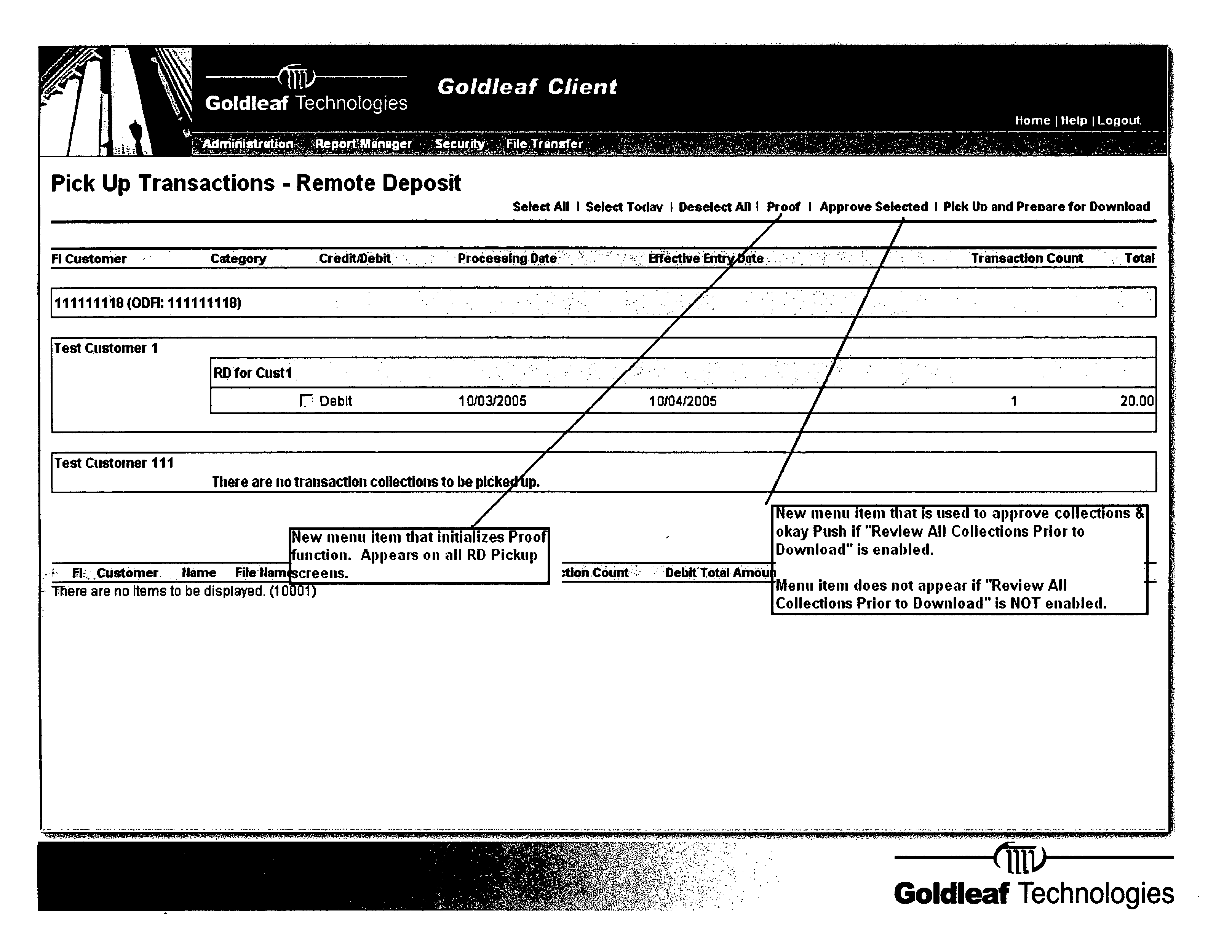

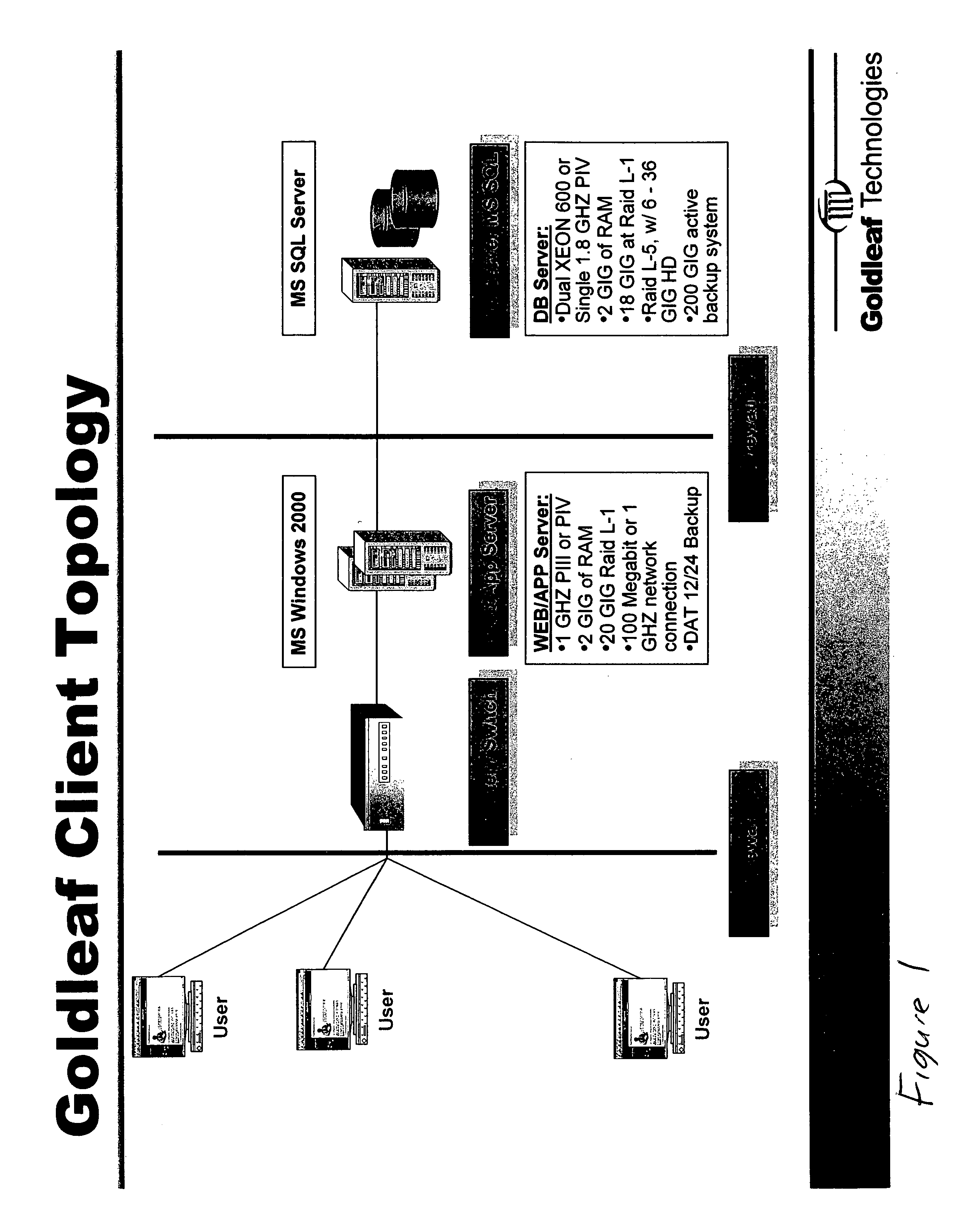

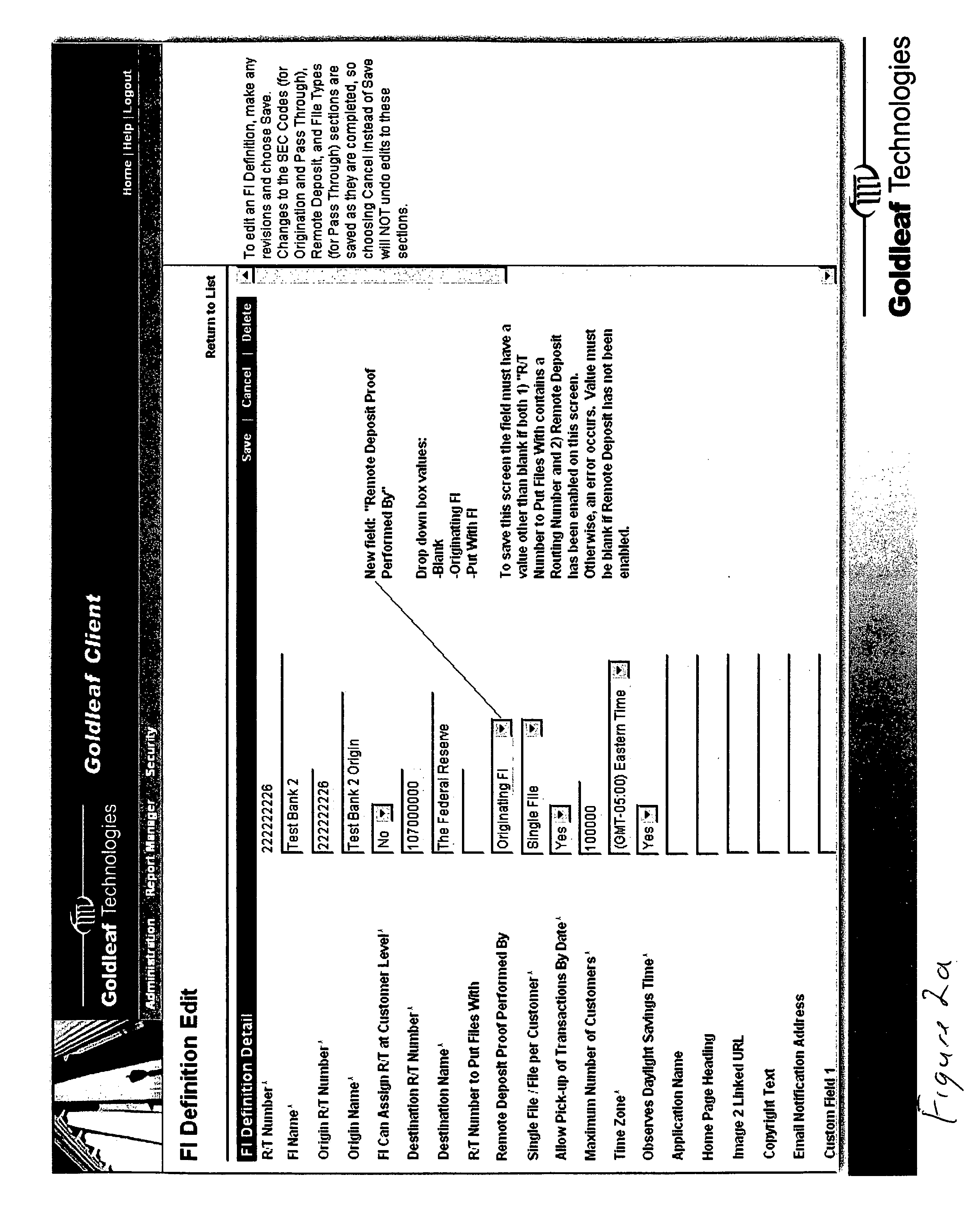

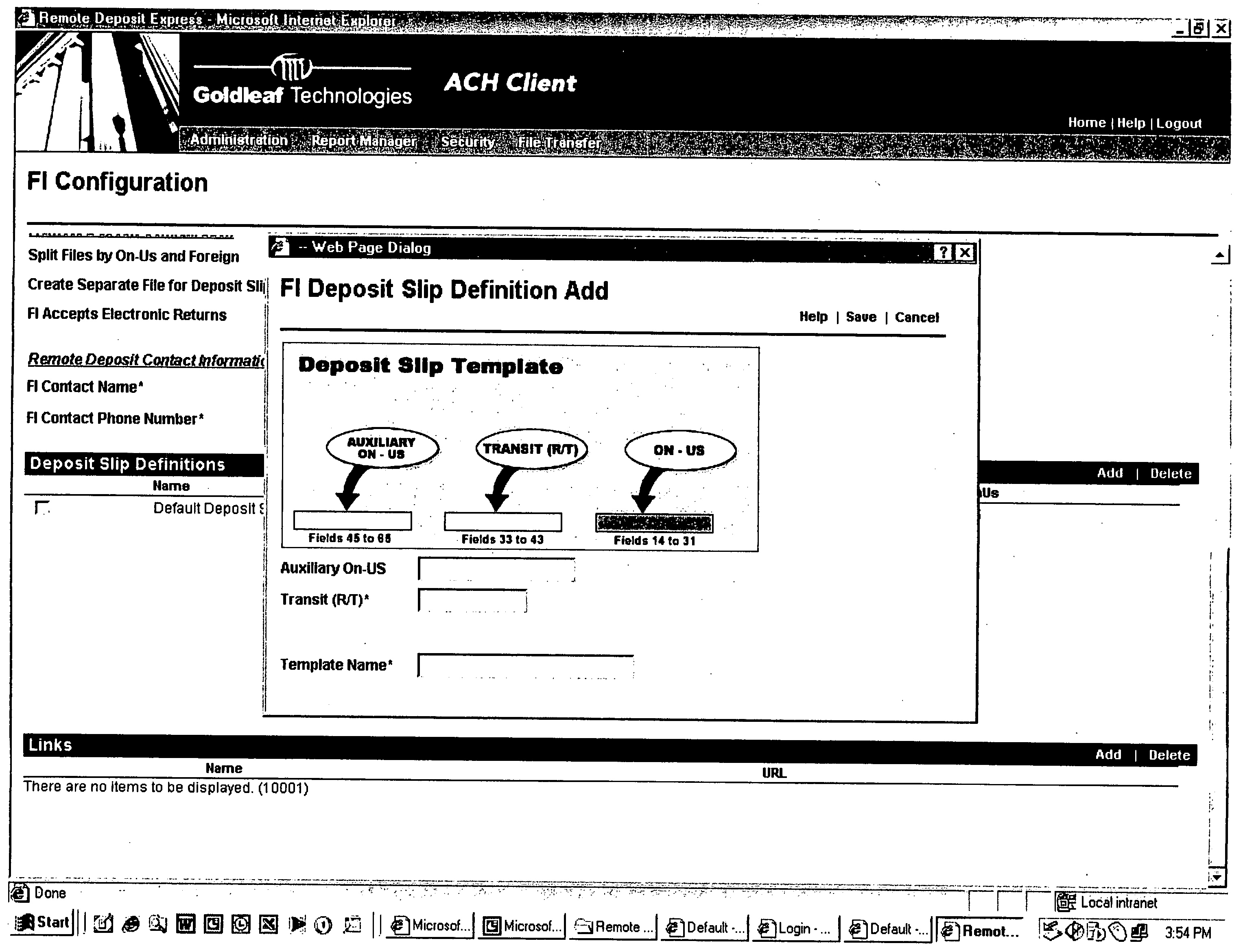

Remote check deposit

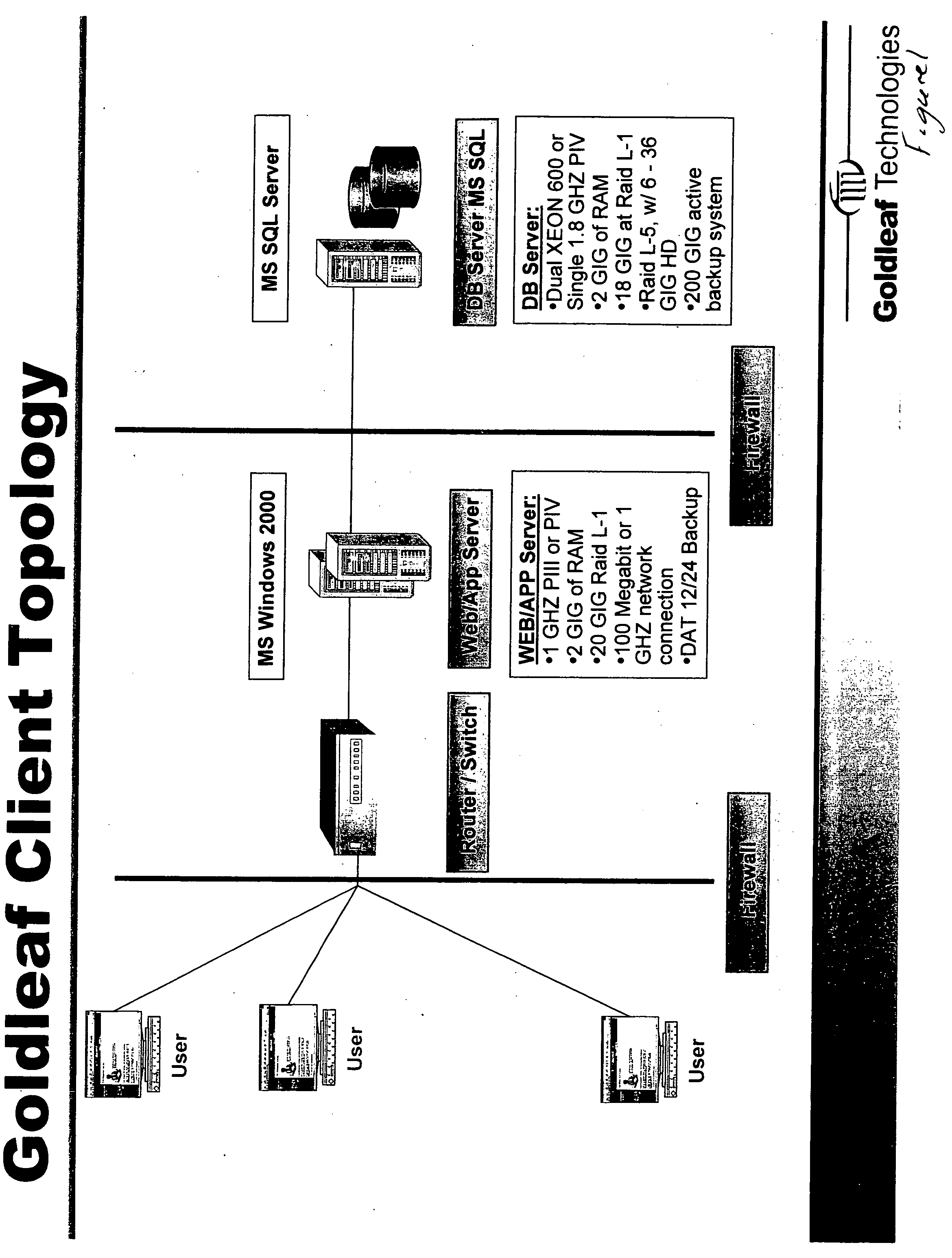

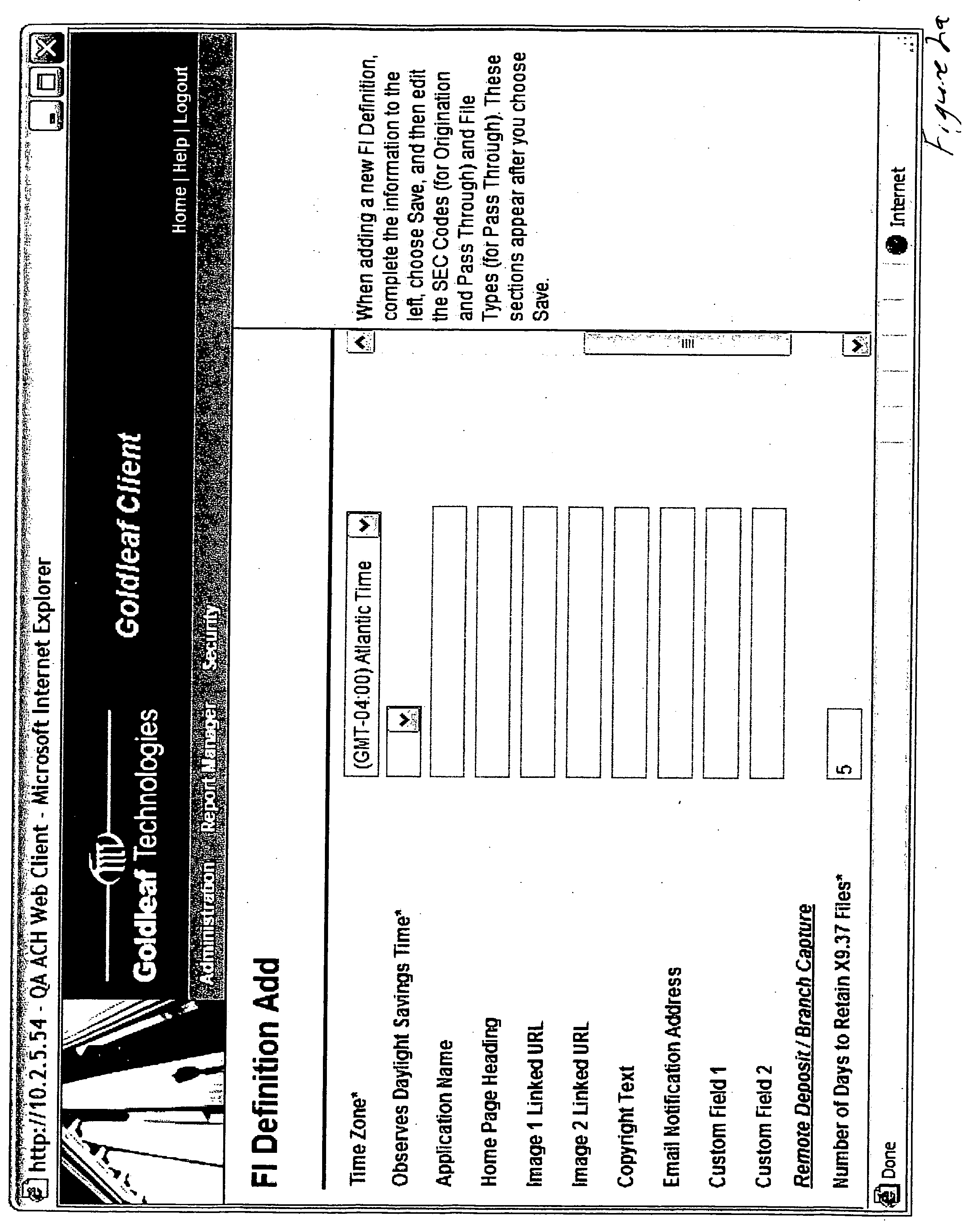

In accordance with the principles of the present invention, a system is provided for capturing a customer deposit at their place of business, converting the Magnetic Ink Character Recognition (MICR) data encoded documents into an image with an associated data file, and electronically transmit the data to a financial institution. The system allows the customer to scan each MICR encoded check that is to be deposited with their financial institution, which captures financial institution routing information and customer account information. The associated image the physical check can be franked denoting the check has been electronically processed to avoid further processing. The resulting image and account data can then be edited and processed by the financial institution. There are three options for encoding the amount: 1) the customer enters each amount after scanning the item prior to sending to the financial institution; 2) the financial institution enters the amount of each item after receiving the file from the customer; and 3) the amount field(s) is scanned and the amount is automatically entered. The system allows for both 1) online (Internet) capture of the MICR data and the associated image or 2) offline capture and the subsequent importing of the image and MICR data for transmission to the financial institution via the Internet. The financial institution can review the items captured online, and repair any item that is incorrect. The financial institution can use the system to print substitute checks that confirm to ANSI X9.90 for processing or deliver an electronic file in ANSI X9.37 format to any check processing system. The system includes secure transport over Internet connections for file transfer and dual control security to reduce fraudulent transactions from being initiated by the customer.

Owner:GOLDLEAF TECH

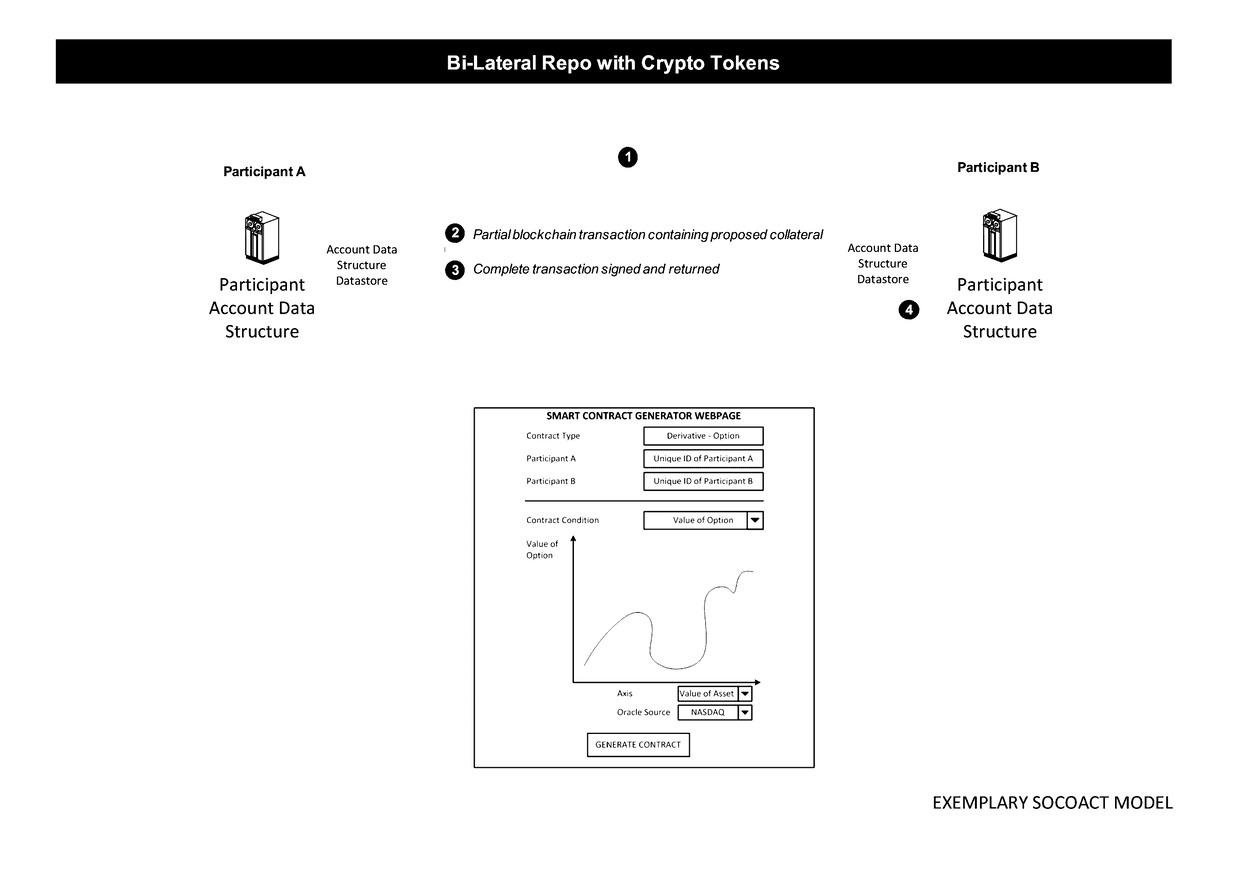

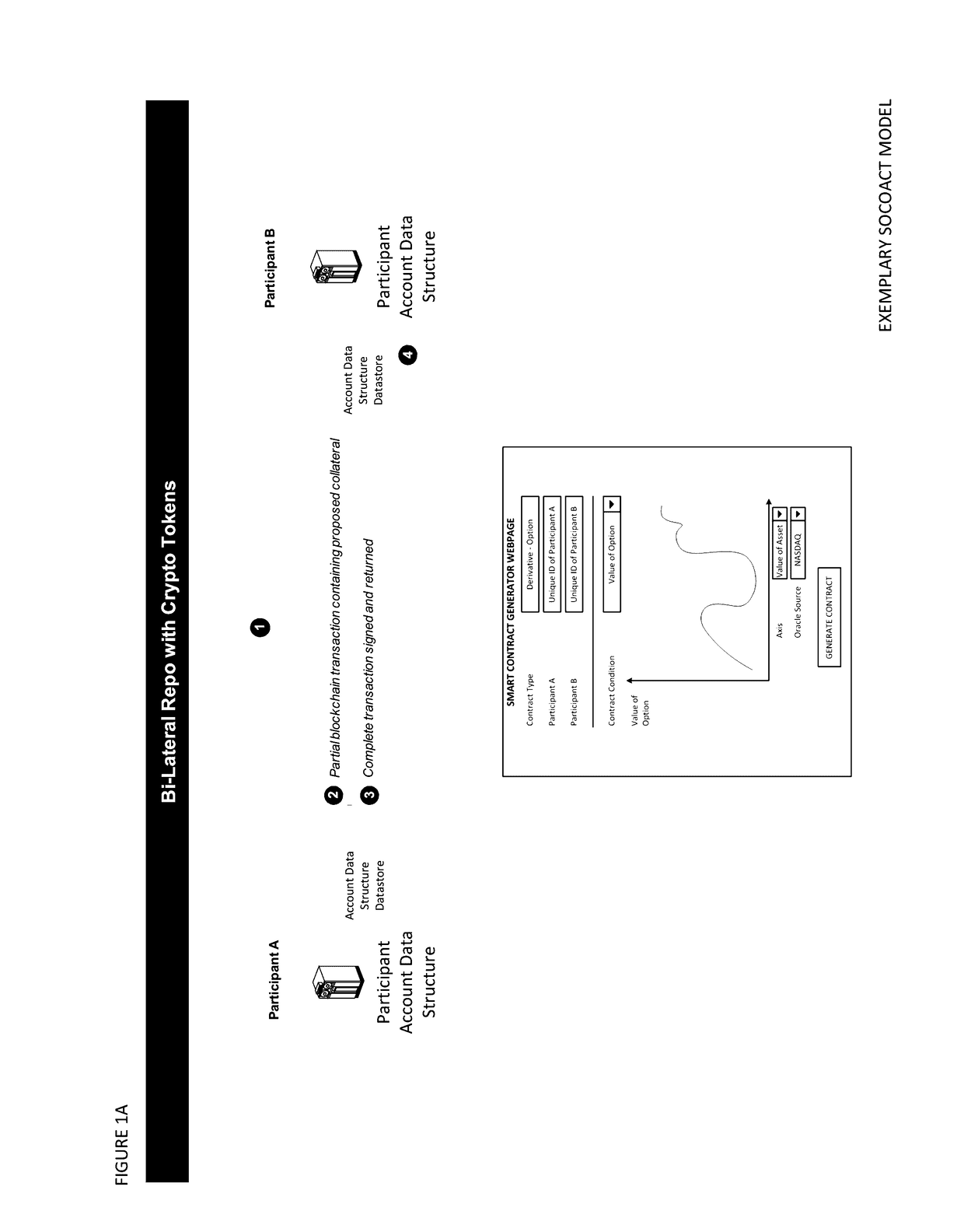

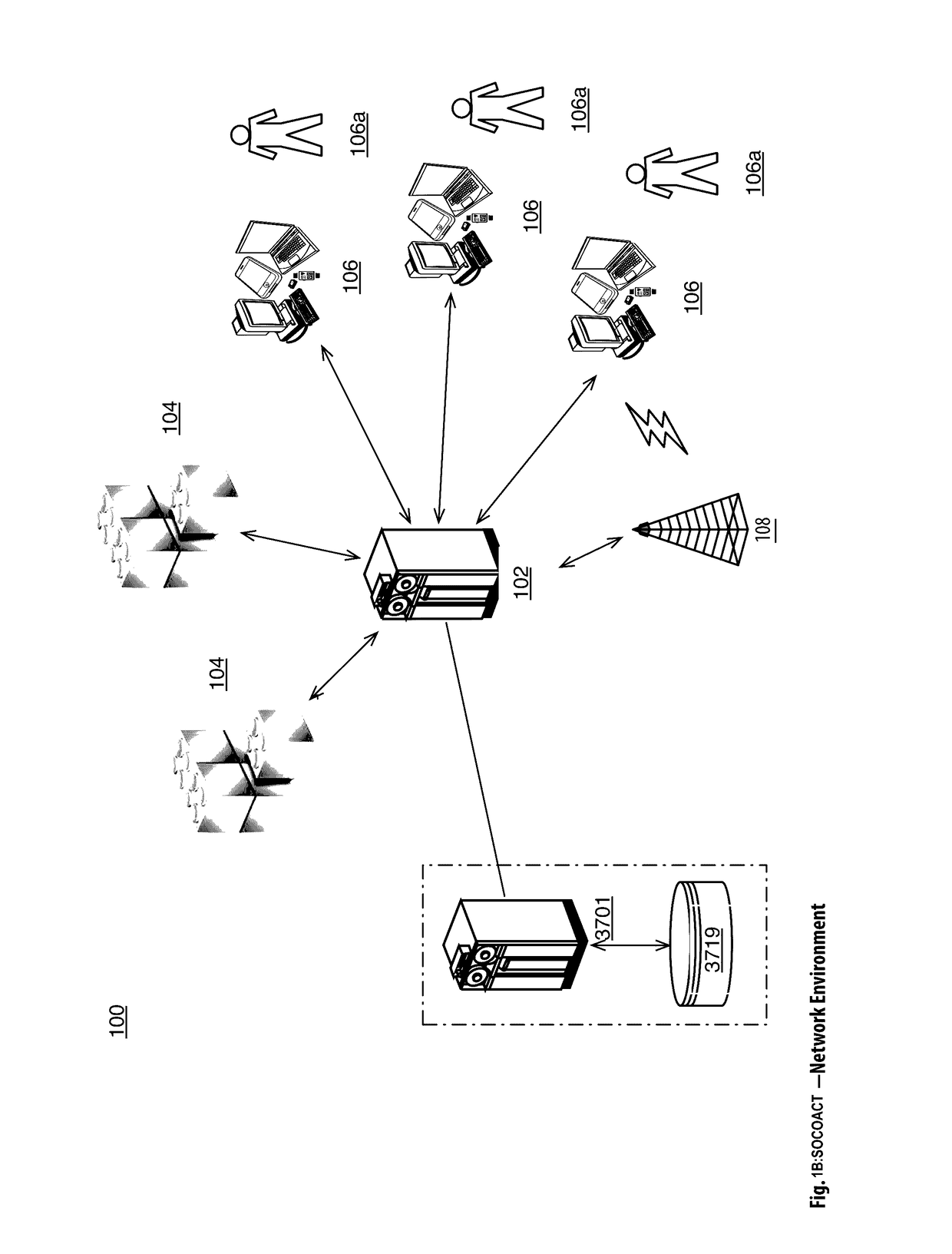

Point-to-Point Transaction Guidance Apparatuses, Methods and Systems

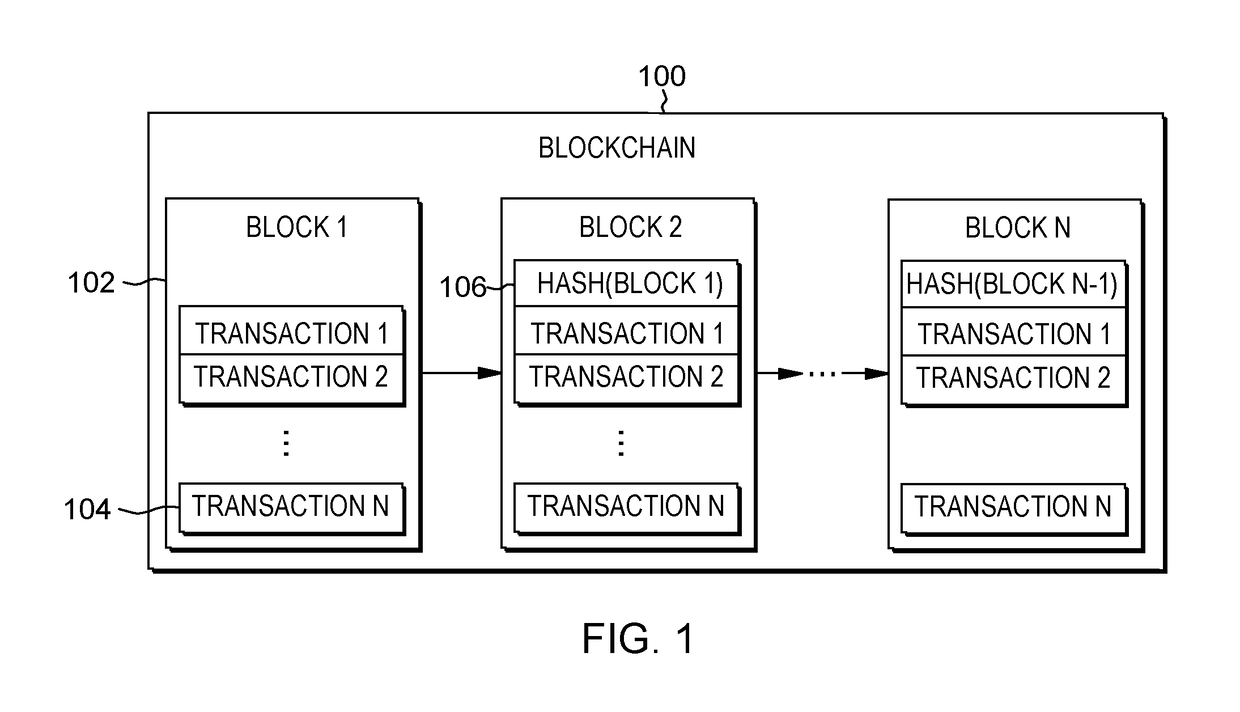

InactiveUS20170085555A1Prolong lifeEasy accessInput/output to record carriersDigital data information retrievalProcessing InstructionSmart contract

The Point-to-Point Transaction Guidance Apparatuses, Methods and Systems (“SOCOACT”) transforms smart contract request, crypto currency deposit request, crypto collateral deposit request, crypto currency transfer request, crypto collateral transfer request inputs via SOCOACT components into transaction confirmation outputs. Also, SOCOACT transforms virtual wallet address inputs via SOCOACT (e.g., P2PTG) components into transaction confirmation outputs. In one embodiment, the SOCOACT includes a point-to-point payment guidance apparatus, comprising, a memory and processor disposed in communication with the memory, and configured to issue a plurality of processing instructions from the component collection stored in the memory, to: obtain a target wallet identifier registration at a beacon. The SOCOACT then may register the target wallet identifier with the beacon and obtain a unique wallet identifier from a migrant wallet source associated with a user at the beacon. The SOCOACT may then obtain a target transaction request at the beacon from the migrant wallet source and commit the target transaction request for the amount specified in the target transaction request to a distributed block chain database configured to propagate the target transaction request across a distributed block chain database network for payment targeted to the target wallet identifier registered at the beacon.

Owner:FMR CORP

Remote check deposit

InactiveUS20060242062A1Easy to optimizeConvenient truncationFinancePayment circuitsDocumentation procedureSubstitute check

In accordance with the principles of the present invention, a system is provided for capturing a customer deposit at their place of business, converting the Magnetic Ink Character Recognition (MICR) data encoded documents into an image with an associated data file, and electronically transmit the data to a financial institution. The system allows the customer to scan each MICR encoded check that is to deposited with their financial institution, which captures financial institution routing information and customer account information. The associated image the physical check can be franked denoting the check has been electronically processed to avoid further processing. The resulting image and account data can then be processed by the financial institution. There are three options for encoding the amount: 1) the customer enters each amount after scanning the item prior to sending to the financial institution; 2) the financial institution enters the amount of each item after receiving the file from the customer; and 3) the amount field(s) are scanned and the amount is automatically entered. The system allows for both 1) online (Internet) capture of the MICR data and the associated image or 2) offline capture and the subsequent importing of the image and MICR data for transmission to the financial institution via the Internet. The financial institution can review the items captured online, and repair any item that is incorrect. The financial institution can use the system to print substitute checks that confirm to ANSI X9.90 for processing or deliver an electronic file in ANSI X9.37 format to any check processing system. The system includes secure transport over Internet connections for file transfer and dual control security to reduce fraudulent transactions from being initiated by the customer.

Owner:GOLDLEAF TECH

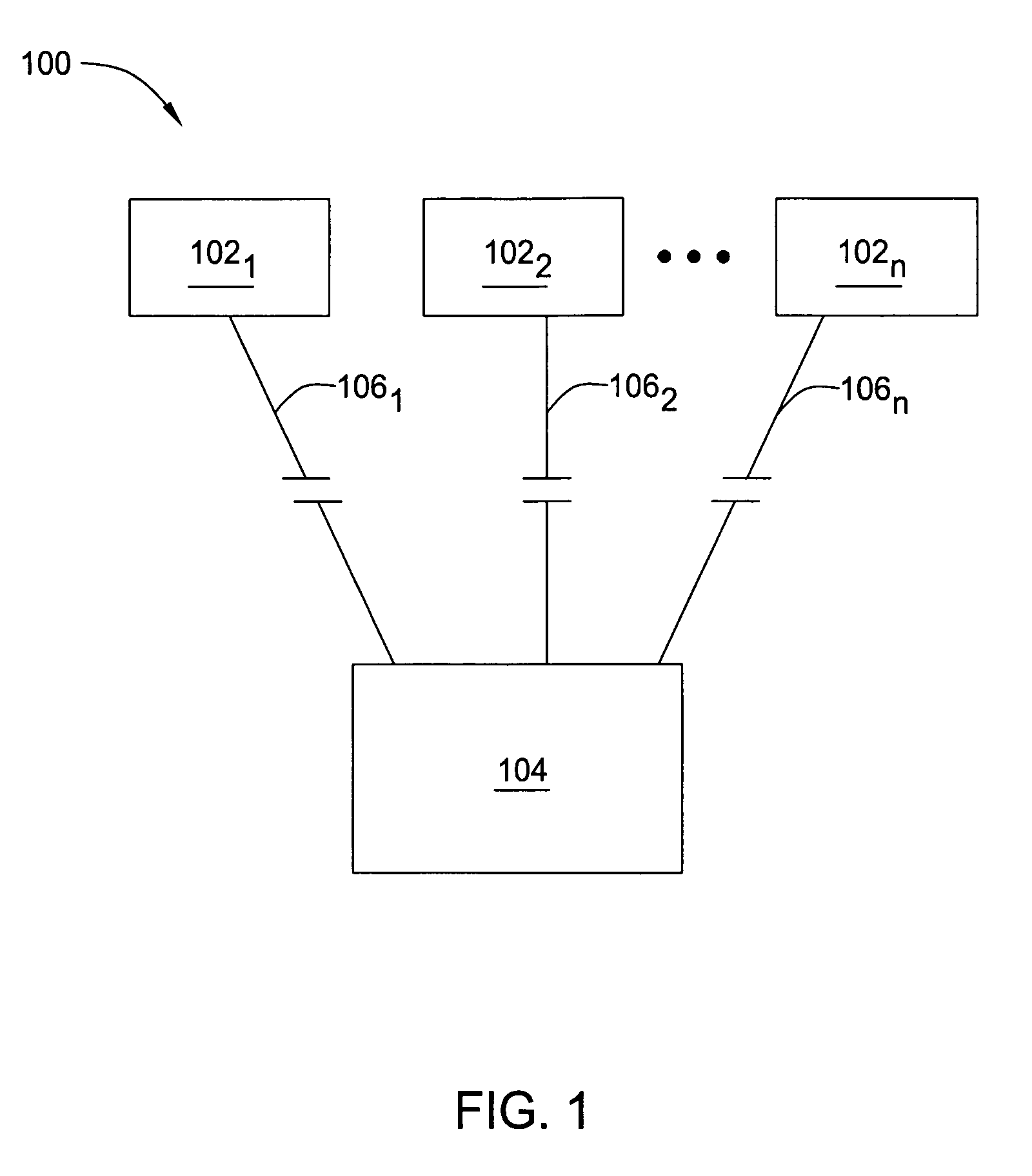

Method and apparatus for synchronizing client transactions executed by an autonomous client

InactiveUS20060010130A1Reducing synchronization-related transaction conflictReduce transactionSpecial data processing applicationsTransaction processingPresent methodTransaction log

One embodiment of the present method and apparatus for synchronization of client transactions executed by an autonomous client enables a client operating on a limited connection to a server to log transactions executed against a locally stored server database state. Logged transactions are then synchronized with a current server database state by delivering the transaction log to the server, which re-executes each logged client transaction against the current server database state, thereby reducing synchronization-related transaction conflicts.

Owner:IBM CORP

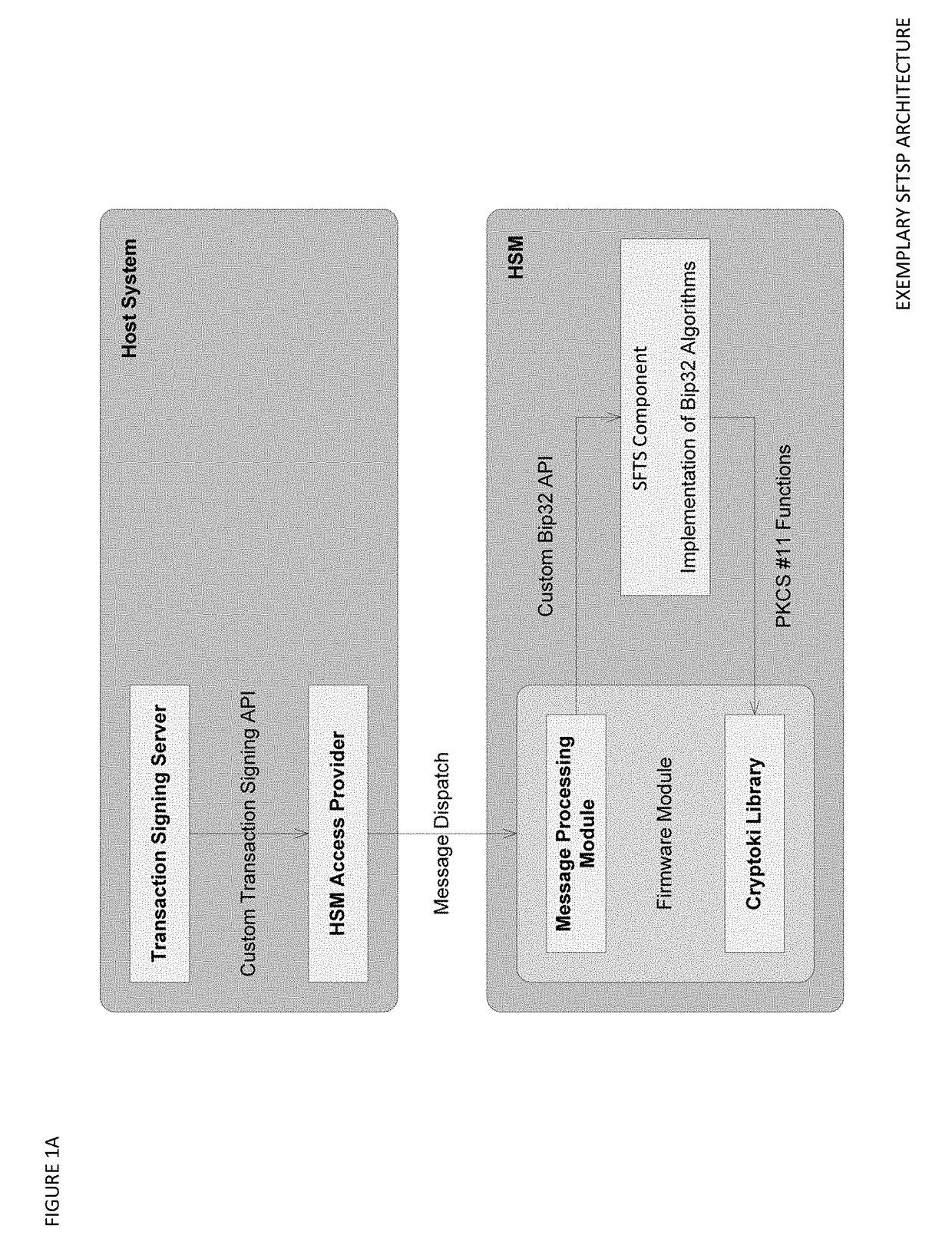

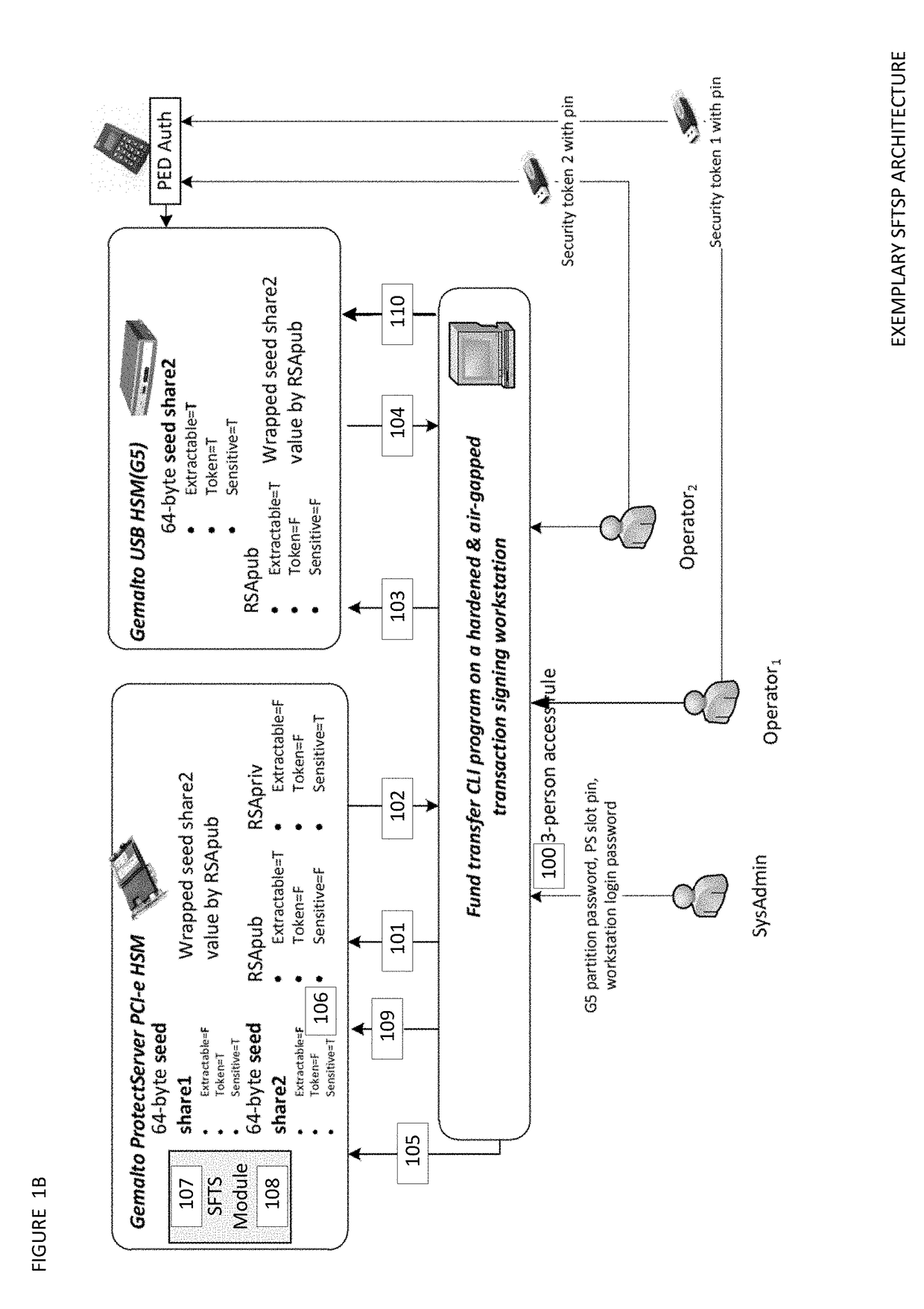

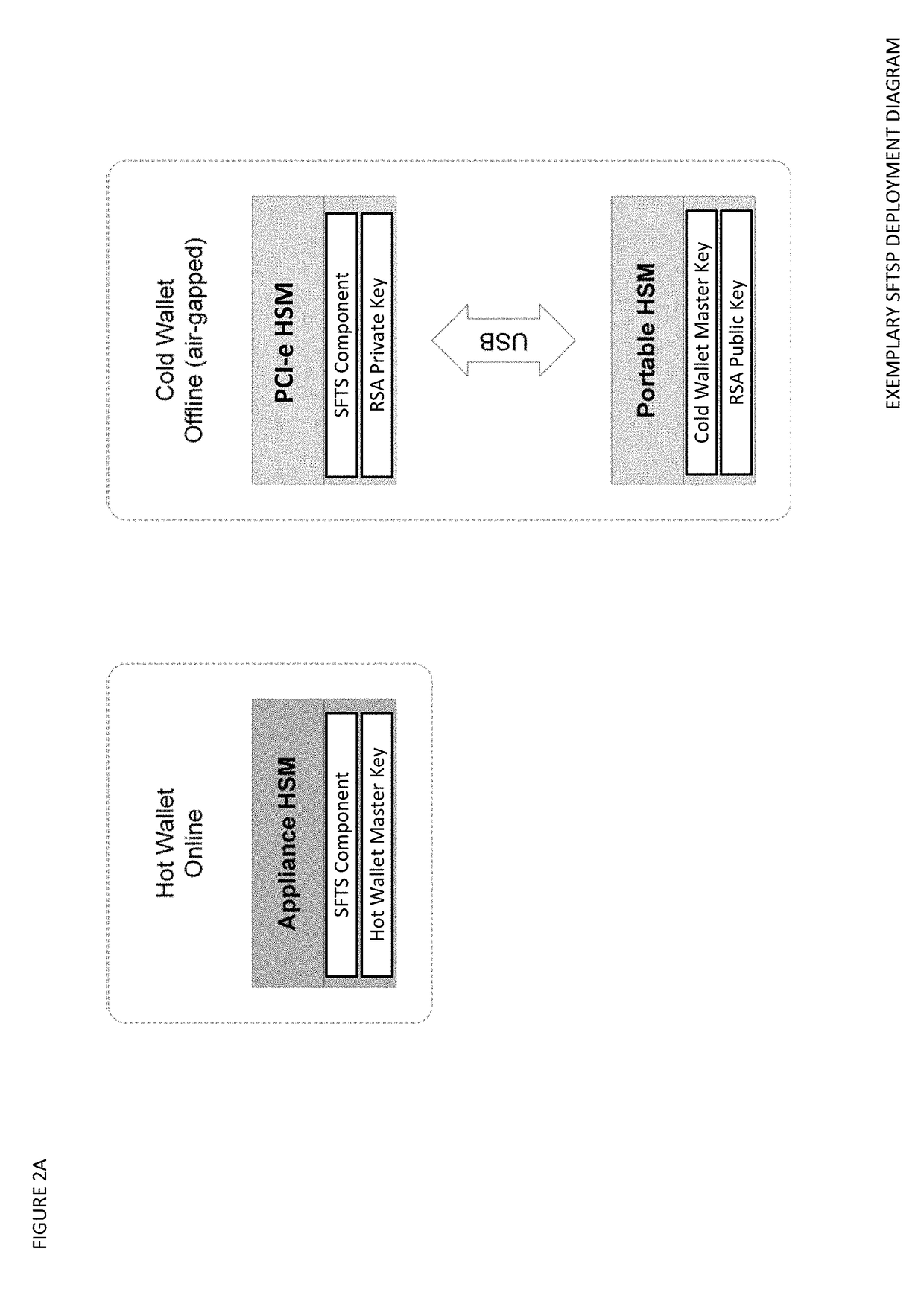

Seed splitting and firmware extension for secure cryptocurrency key backup, restore, and transaction signing platform apparatuses, methods and systems

ActiveUS20180367316A1Improve network efficiencyProlong lifeKey distribution for secure communicationEncryption apparatus with shift registers/memoriesMaster keyKey sharing

The Seed Splitting and Firmware Extension for Secure Cryptocurrency Key Backup, Restore, and Transaction Signing Platform Apparatuses, Methods and Systems (“SFTSP”) transforms transaction signing request, key backup request, key recovery request inputs via SFTSP components into transaction signing response, key backup response, key recovery response outputs. A transaction signing request message for a transaction is received by a first HSM and includes an encrypted second master key share from a second HSM whose access is controlled by M-of-N authentication policy. The encrypted second master key share is decrypted. A first master key share is retrieved. A master private key is recovered from the master key shares. A transaction hash and a keychain path is determined. A signing private key for the keychain path is generated using the recovered master private key. The transaction hash is signed using the signing private key, and the generated signature is returned.

Owner:FMR CORP

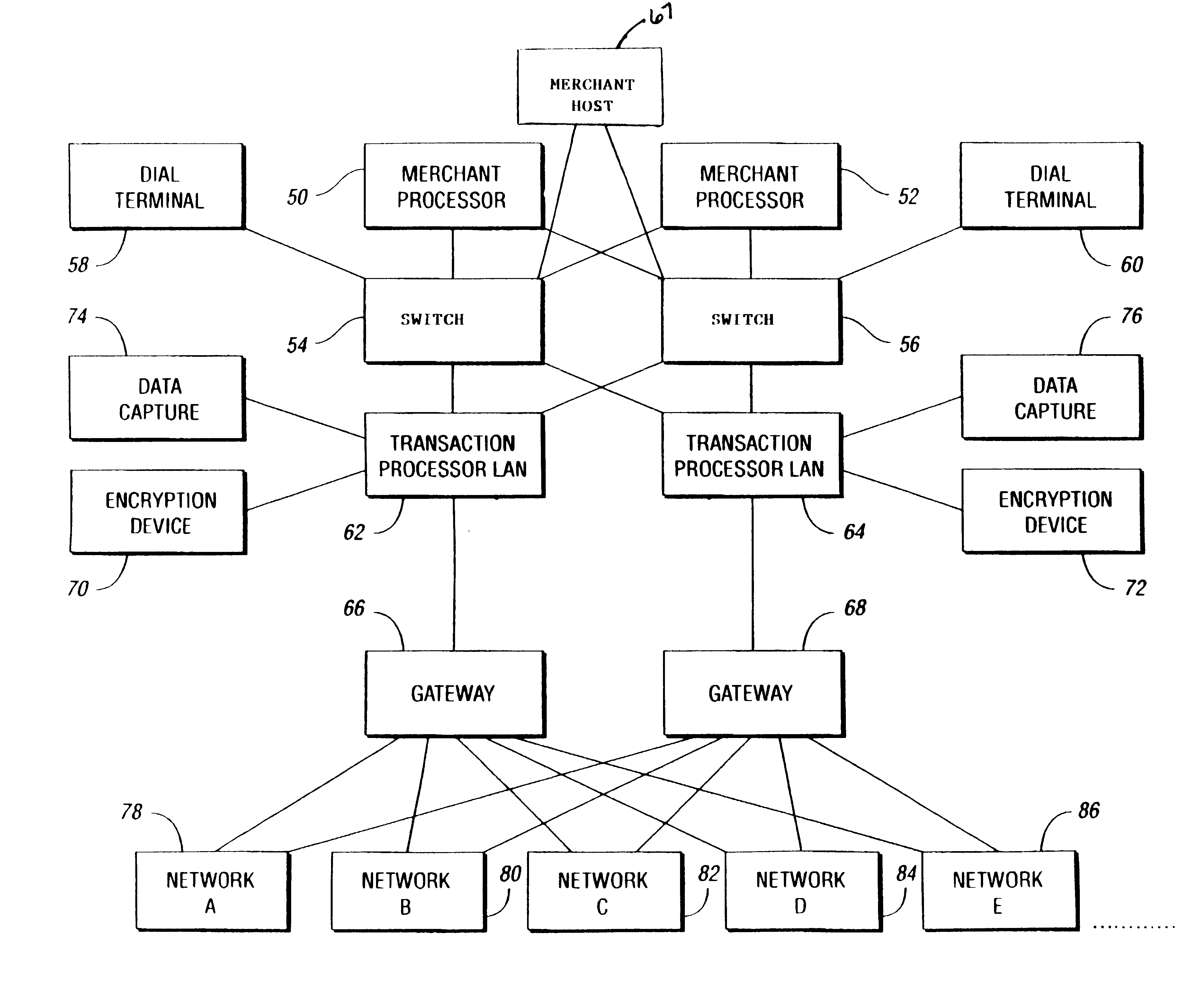

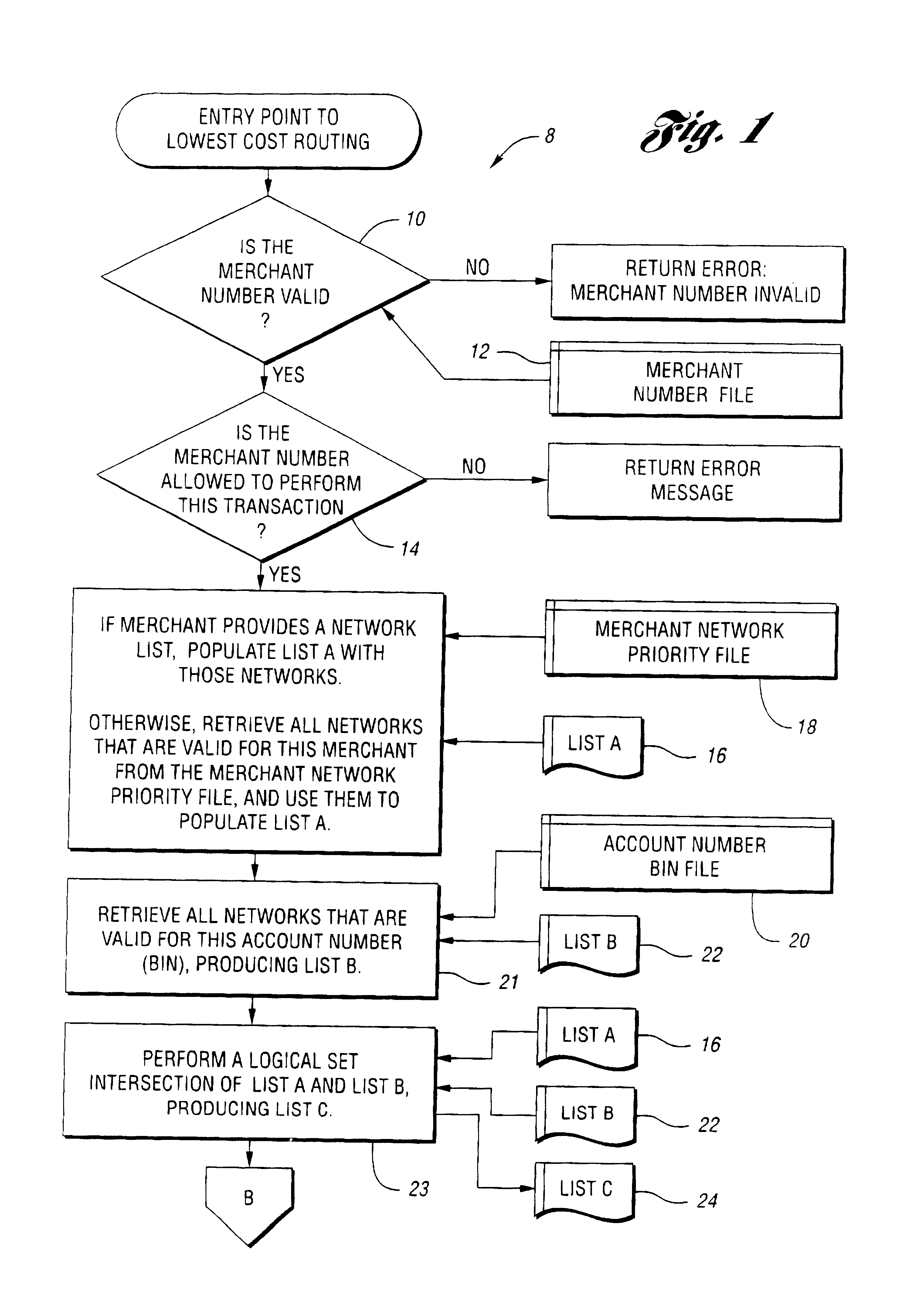

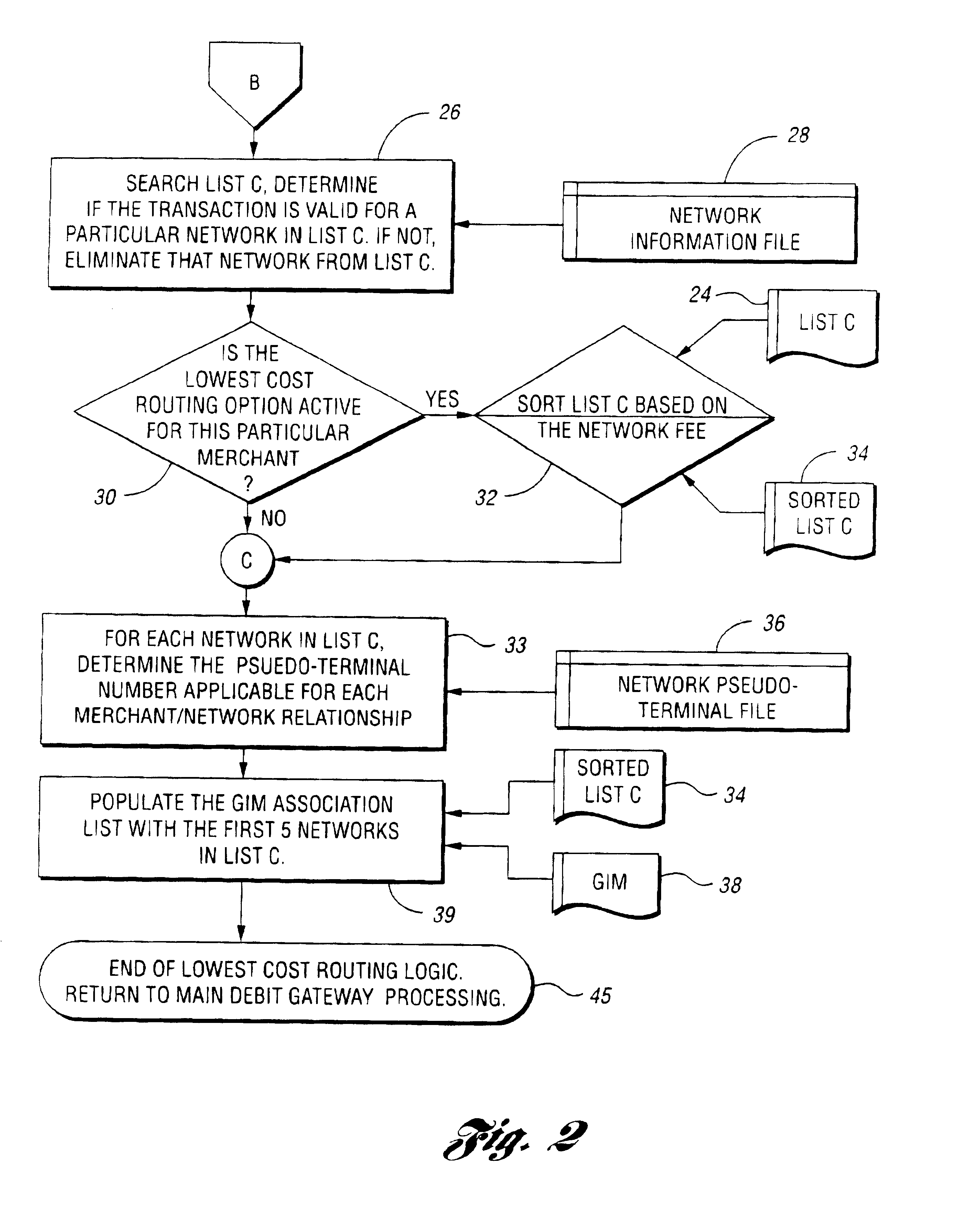

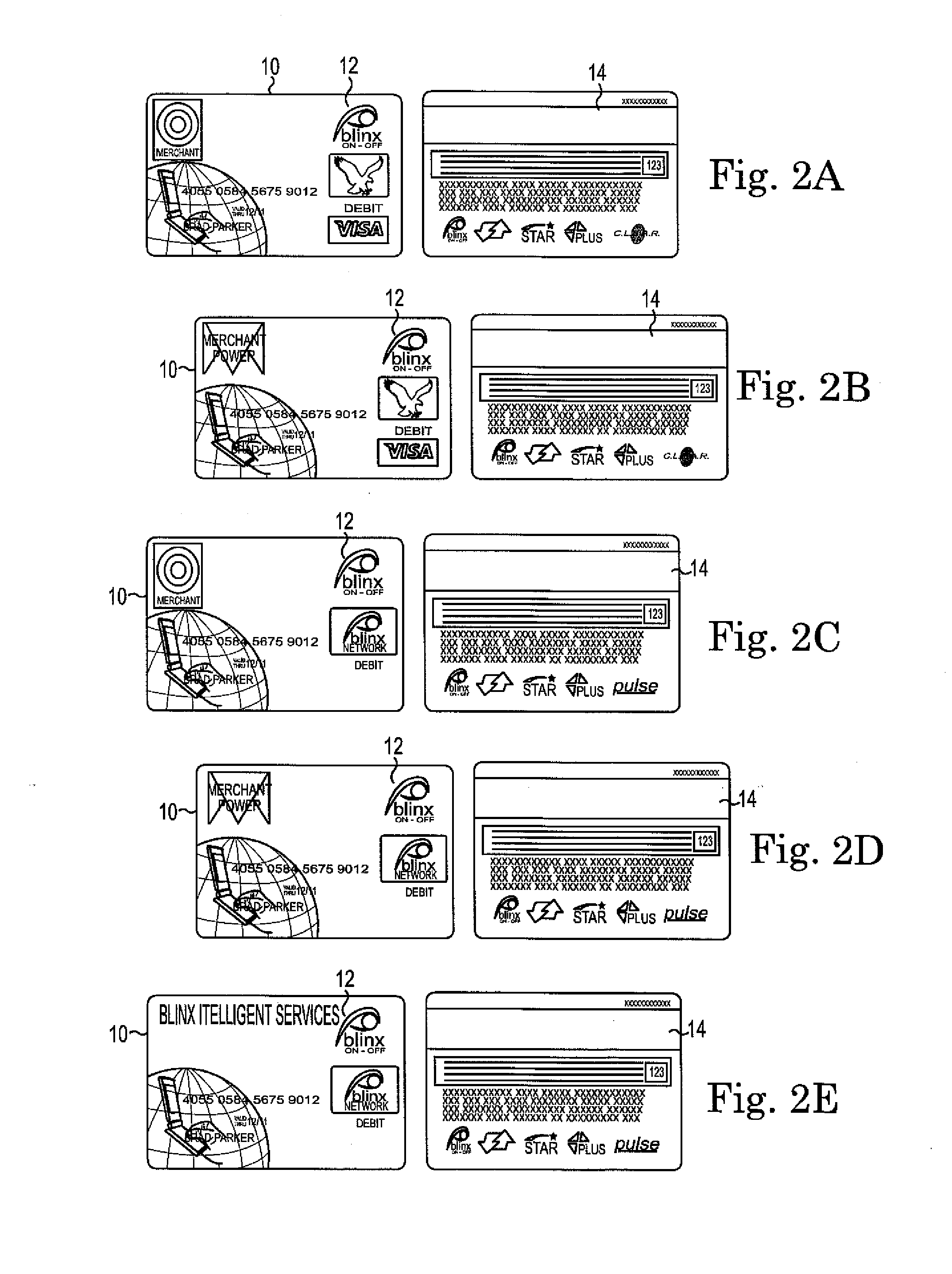

Method and system for reduced cost debit processing

InactiveUS6847947B1Low costReduce transactionFinancePayment circuitsCustomer identificationDistributed computing

A method is provided for processing debit transactions at the lowest cost available. The method is comprised of the following steps: providing a merchant identification number and an account number BIN file to a debit processing center; matching the merchant identification number against at least one merchant database at the debit processing center; providing a merchant network list from the at least one merchant database based upon the match of the merchant identification number; providing a customer network list from the at least one merchant database based upon the match of customer identification number; creating a merchant-customer network list by matching at least one common element from the merchant network list and the customer network list. Next the system determines the validity for each common element of the merchant-customer network list and eliminates each invalid common element from the merchant-customer network list. Subsequently, the system sorts the elements of the merchant-customer network list based on network fee and communicates with a routing and processing database to determine the routing and processing method for each merchant customer element. Finally, the system applies the lowest cost element for routing and processing a debit transaction.

Owner:FIRST DATA

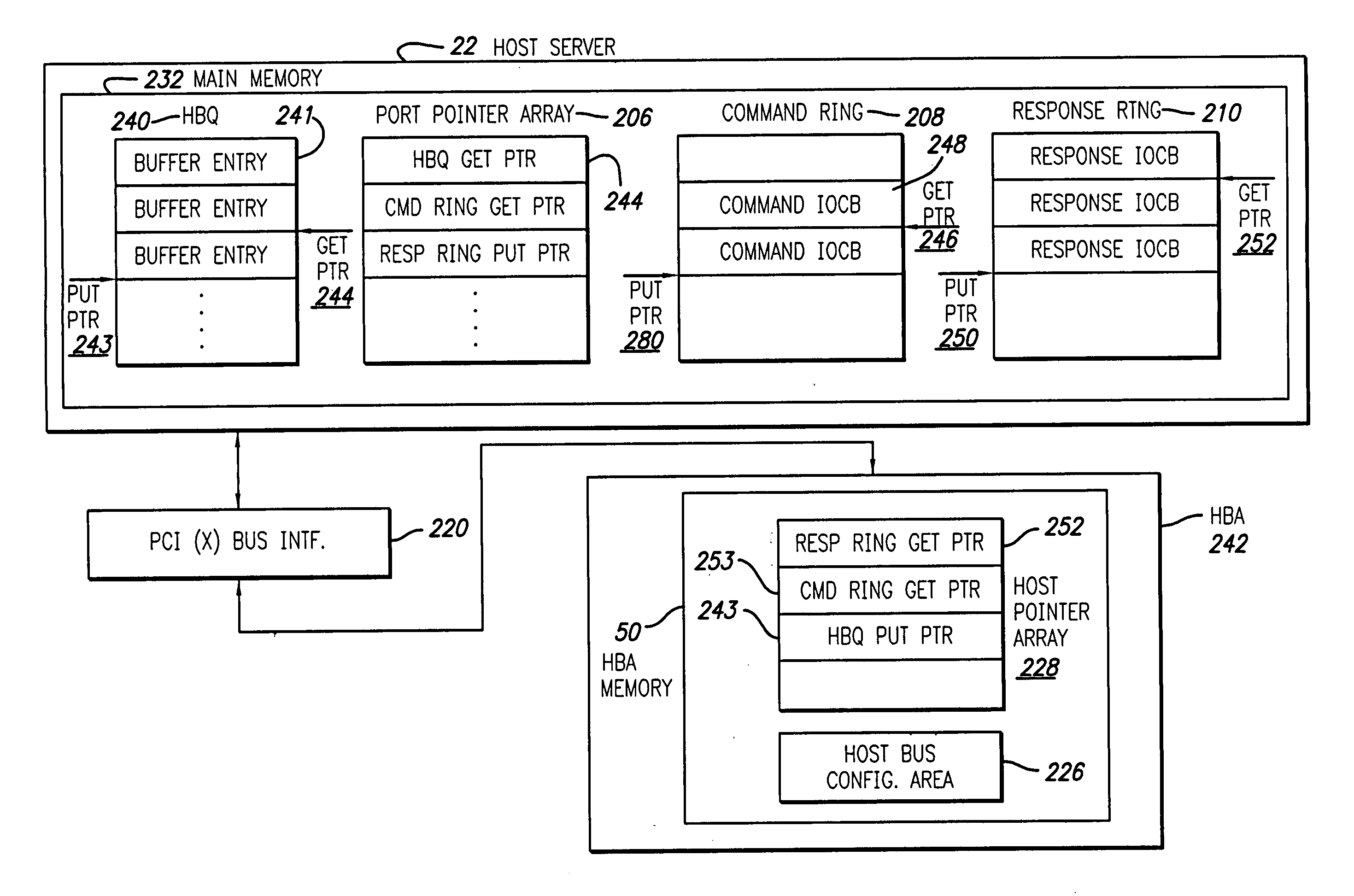

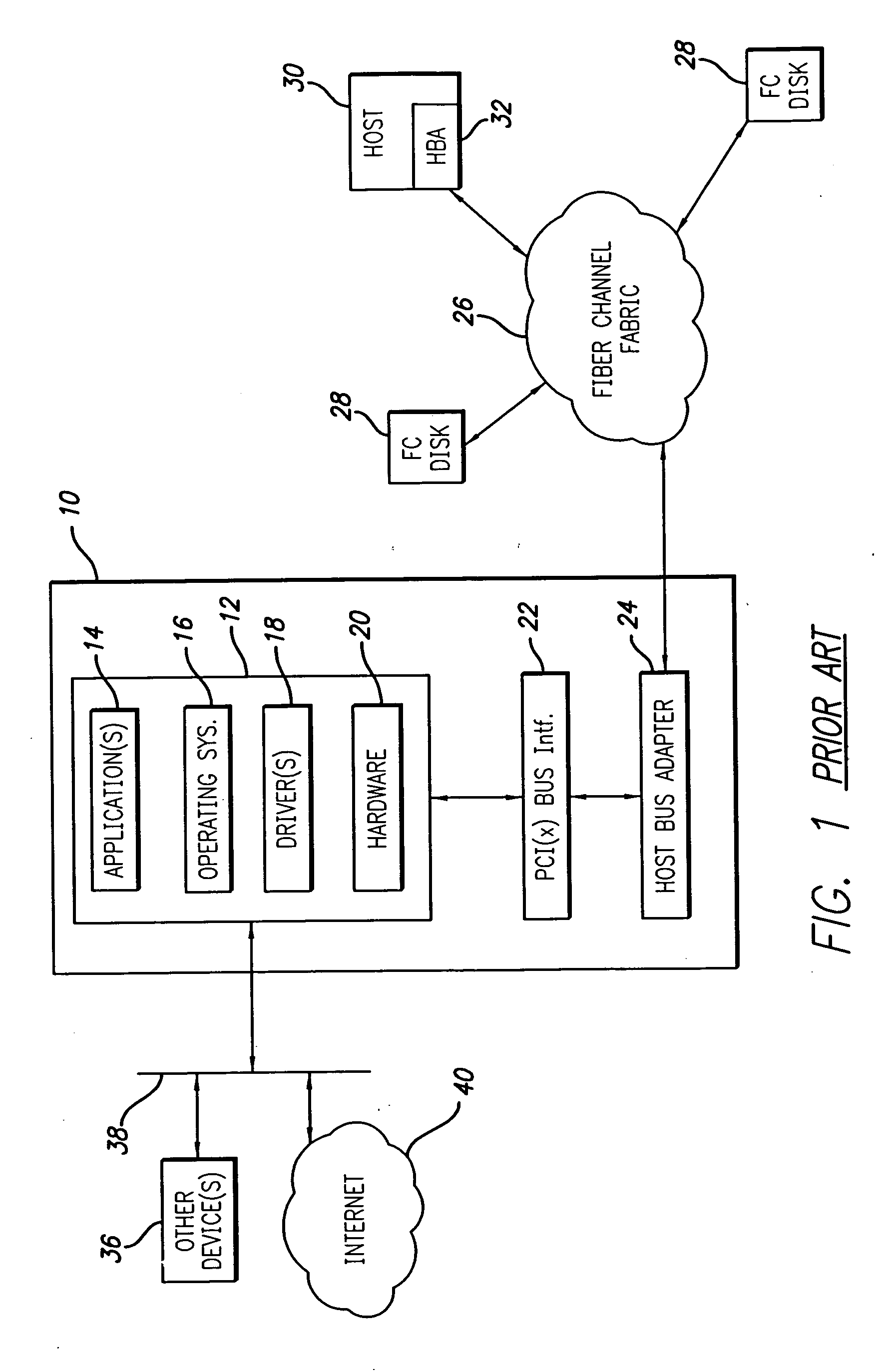

Host buffer queues

InactiveUS20060161733A1Reduce transactionReduce usageUnauthorized memory use protectionStorage area networkImproved method

The preferred embodiment of present invention is directed to an improved method and system for buffering incoming / unsolicited data received by a host computer that is connected to a network such as a storage area network. Specifically, in a host computer system in which the main memory of the host server maintains a I / O control block command ring, and which a connective port (e.g., a host bus adaptor) is operatively coupled to the main memory for handling I / O commands received by and transmitted from the host server, a host buffer queue (HBQ) is maintained for storing a series of buffer descriptors retrievable by the port for writing incoming / unsolicited data to specific address locations within the main memory. In an alternative embodiment of the present invention, multiple HBQs are maintained for storing buffer entries dedicated to different types and / or lengths of data, where each of the HBQ can be separately configured to contain a selection profile describing the specific type of data for which the HBQ is dedicated to service.

Owner:AVAGO TECH WIRELESS IP SINGAPORE PTE

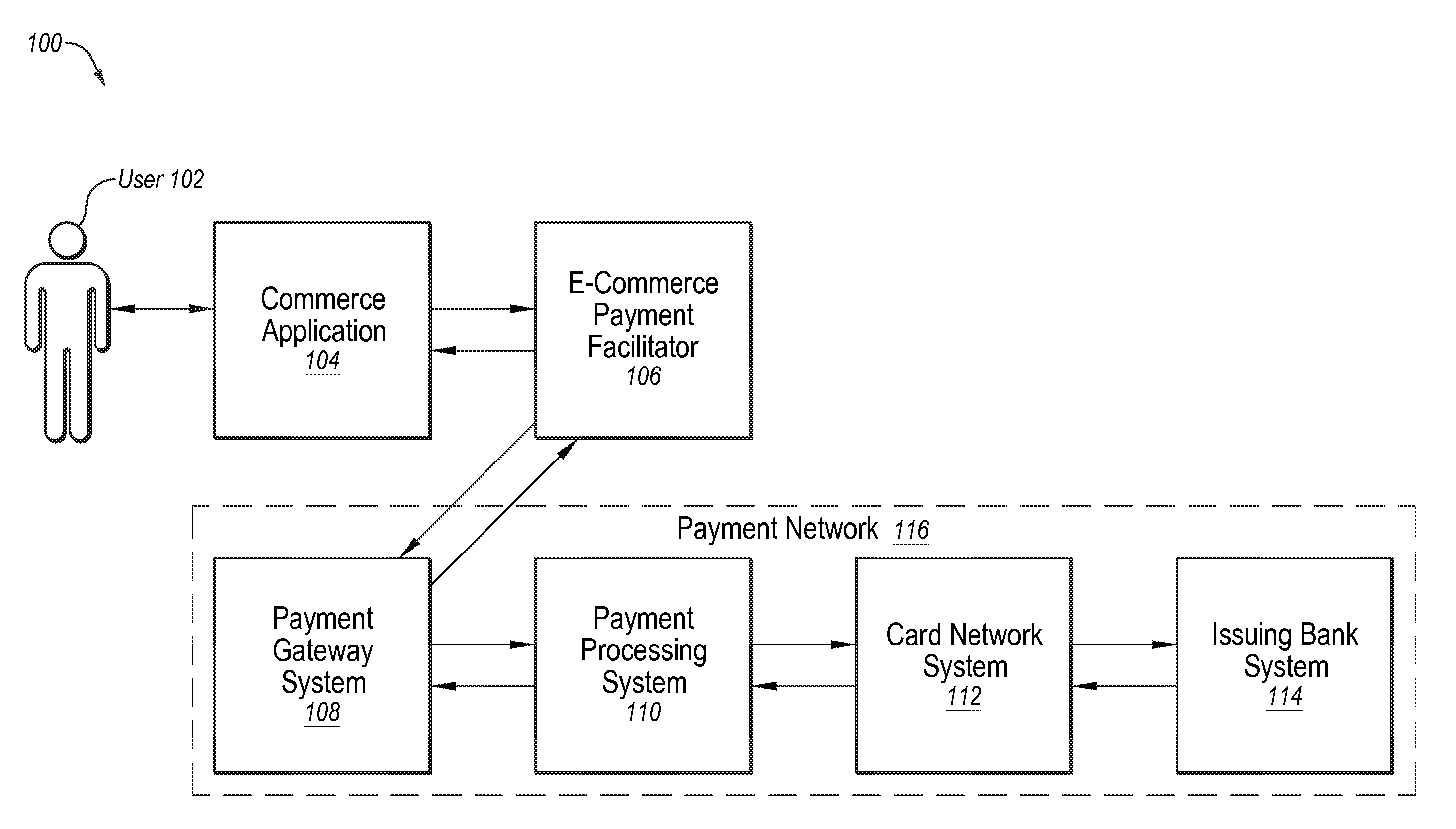

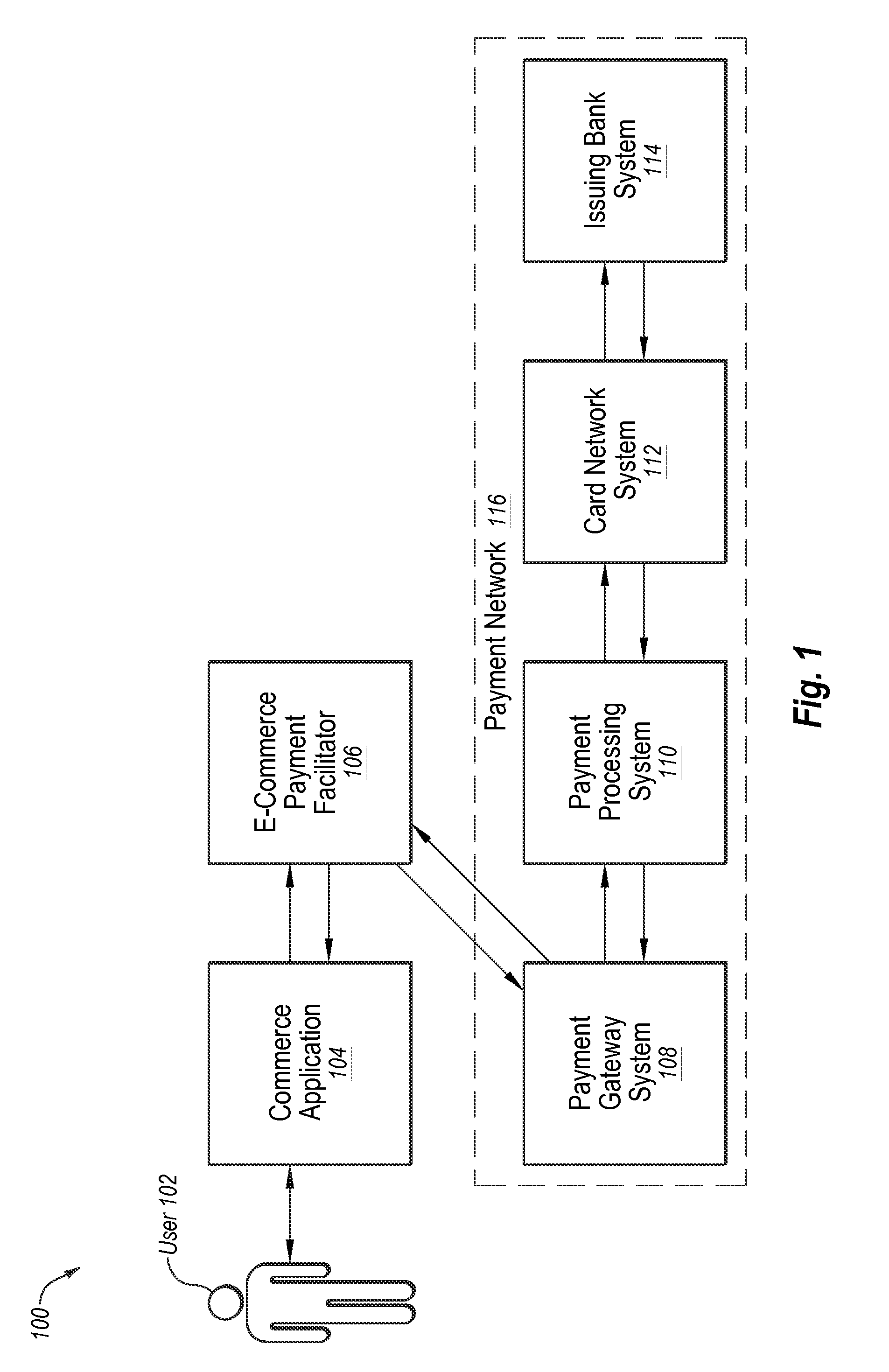

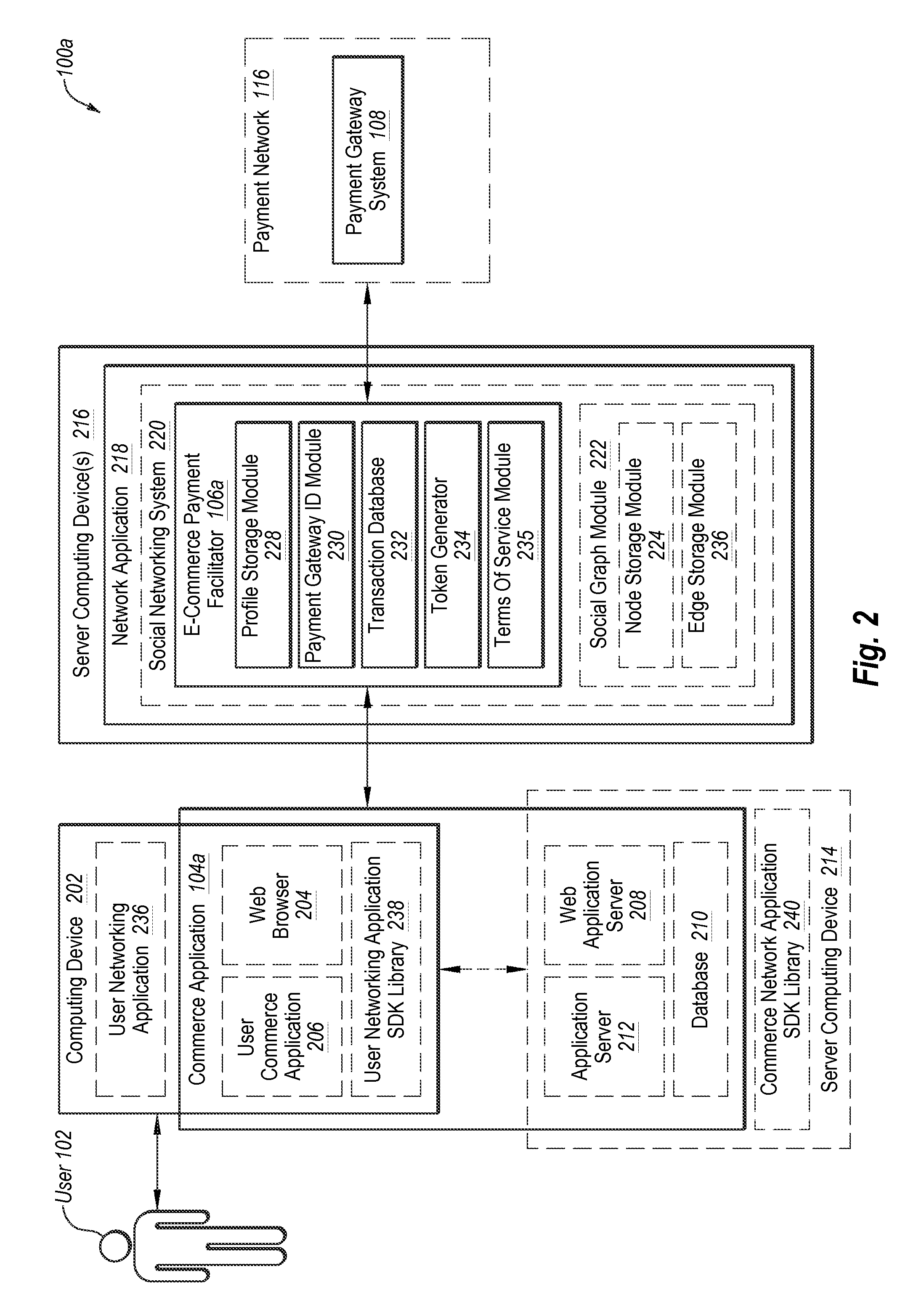

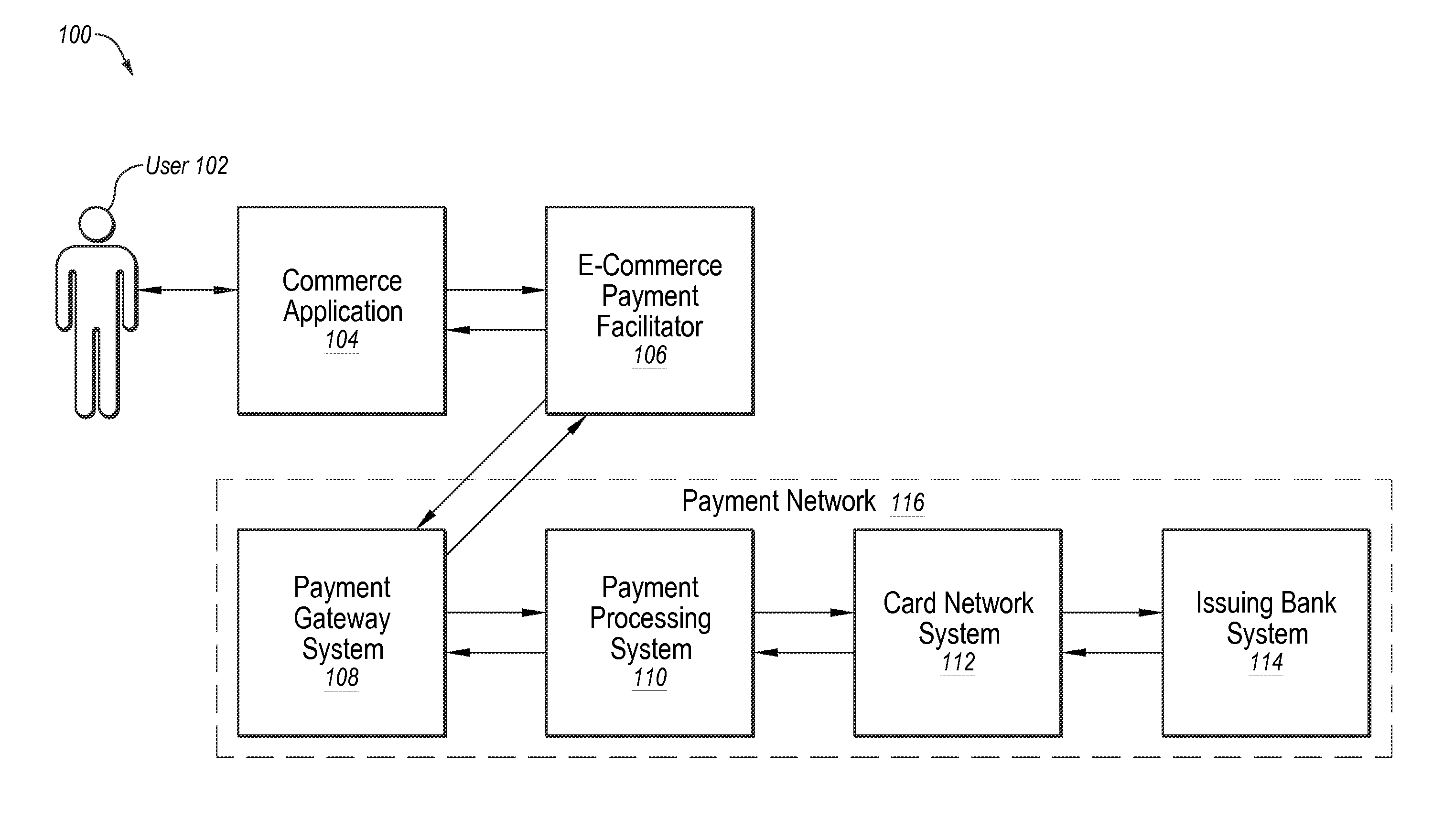

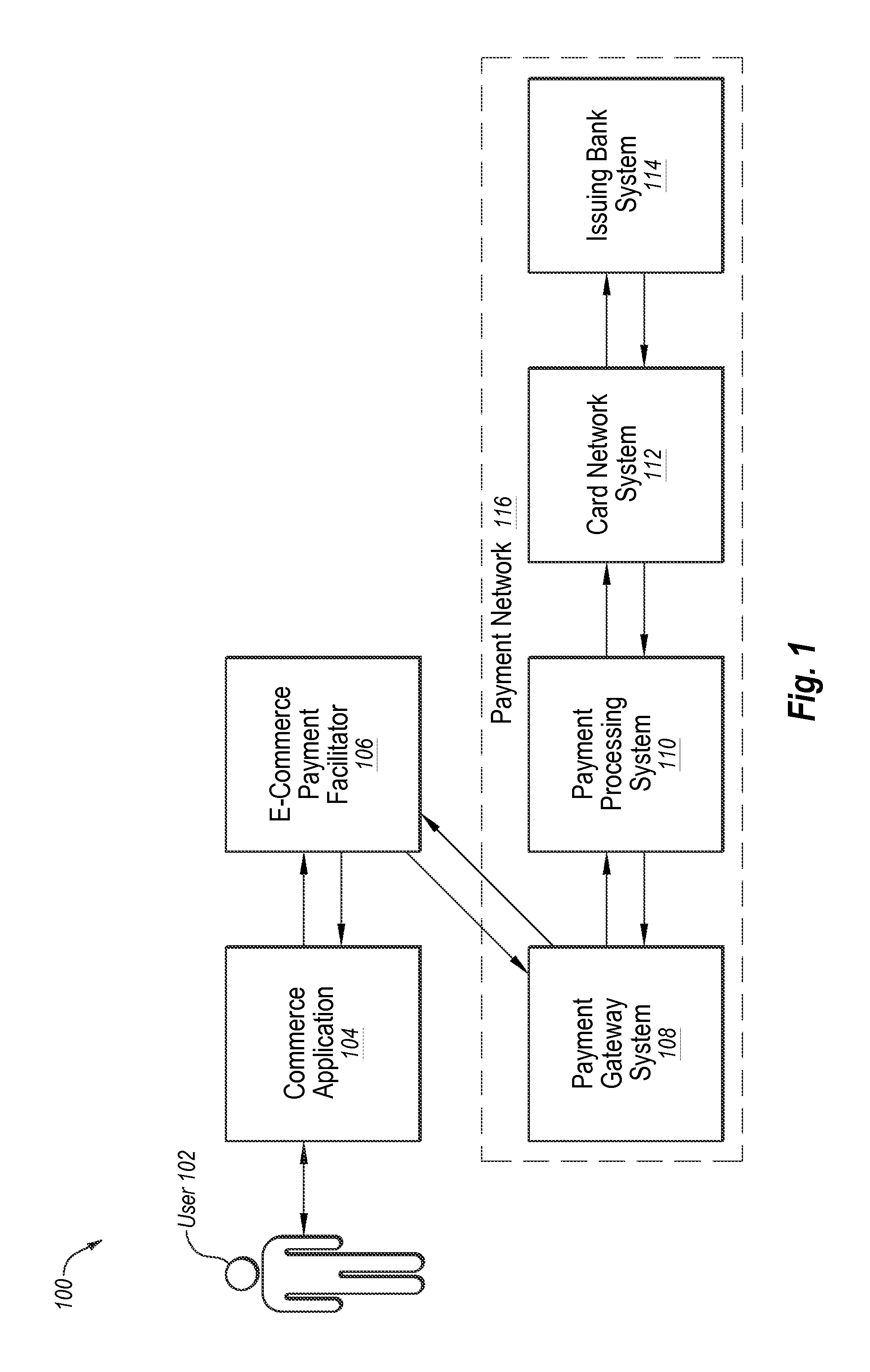

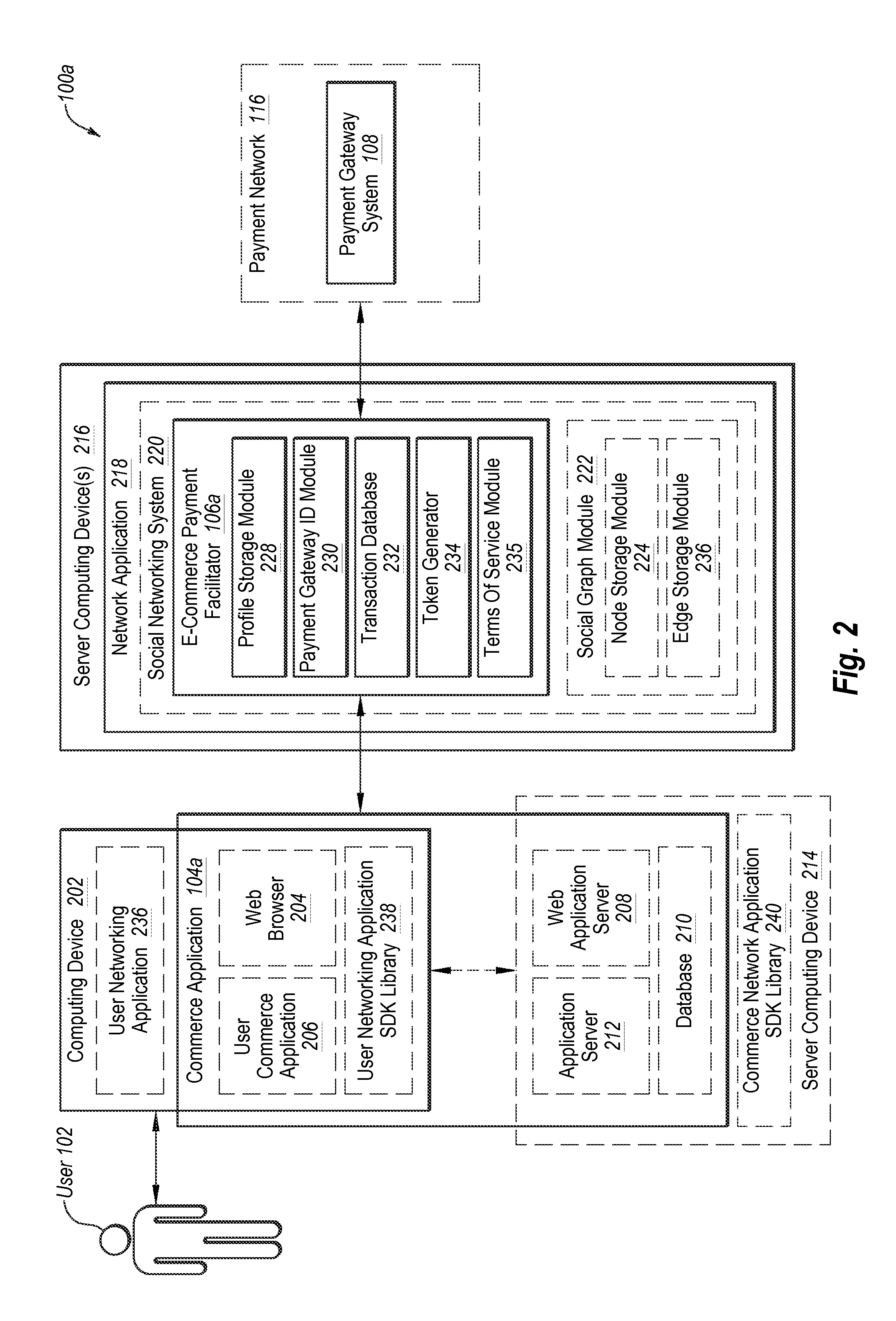

Methods and systems for facilitating e-commerce payments

ActiveUS20150052061A1Improve easeImprove efficiencyFinanceProtocols using social networksPaymentE-commerce

Methods for facilitating financial transactions include facilitating or otherwise increasing the ease and speed of checkout processes. In particular, one or more implementations comprise an e-commerce payment facilitator that acts as an intermediary between a commerce application and a payment gateway. The e-commerce payment facilitator can provide stored payment information to a commerce application based on a few simple selections by a user. This allows a user to easily and securely complete commerce transactions, which simplifies the user's checkout experience and reduces barriers to purchase. Furthermore, the e-commerce payment facilitator can pass payment details to the commerce application's payment gateway. In addition to the foregoing, methods involve dynamically and intelligently providing a user the option of using payment information stored by the network application.

Owner:META PLATFORMS INC

Remote purchasing system and method

ActiveUS20090070230A1Increasing branding opportunityReduce riskCredit schemesBuying/selling/leasing transactionsLocation based informationPurchasing

A scheme for enabling the remote purchasing of products or services based on a recipient's location. In one embodiment, a computer-implemented method for enabling a purchaser to purchase a product or service for a specified recipient different from the purchaser includes: (a) receiving location-based information obtained from a device or token associated with the recipient; (b) generating a list of one or more possible venues based on the location-based information; (c) presenting to the purchaser, via a first communications device, the list of one or more possible venues; (d) receiving from the purchaser a selection of a set of one or more venues from the list of one or more possible venues; (e) receiving, via the first communications device, an instruction from the purchaser to purchase at least one selected product or service for the recipient, the at least one selected product or service to be provided to the recipient in person at any venue in the set of one or more venues; and (f) providing to the recipient, via a second communications device, a notification corresponding to the instruction.

Owner:GULA CONSULTING LLC

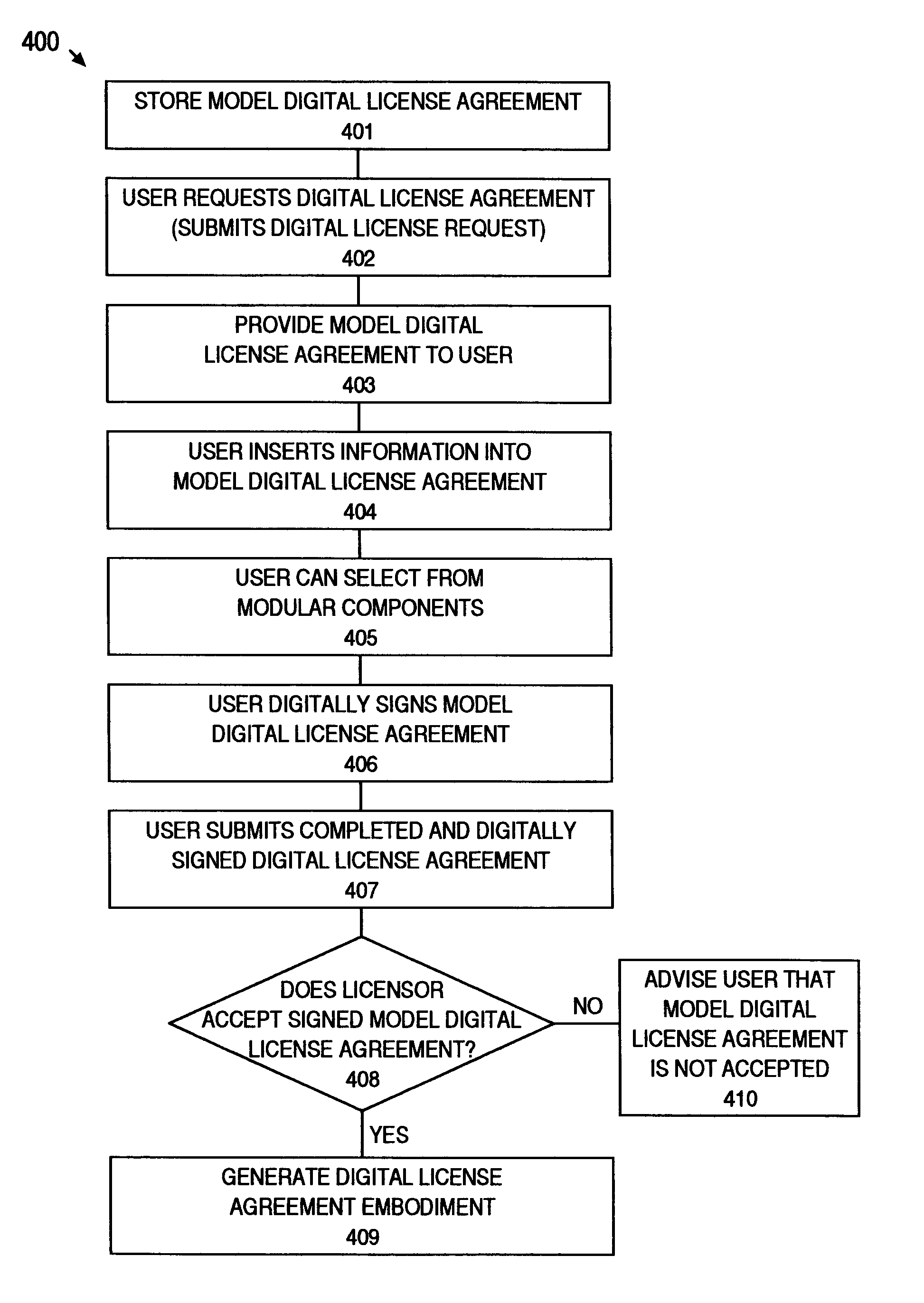

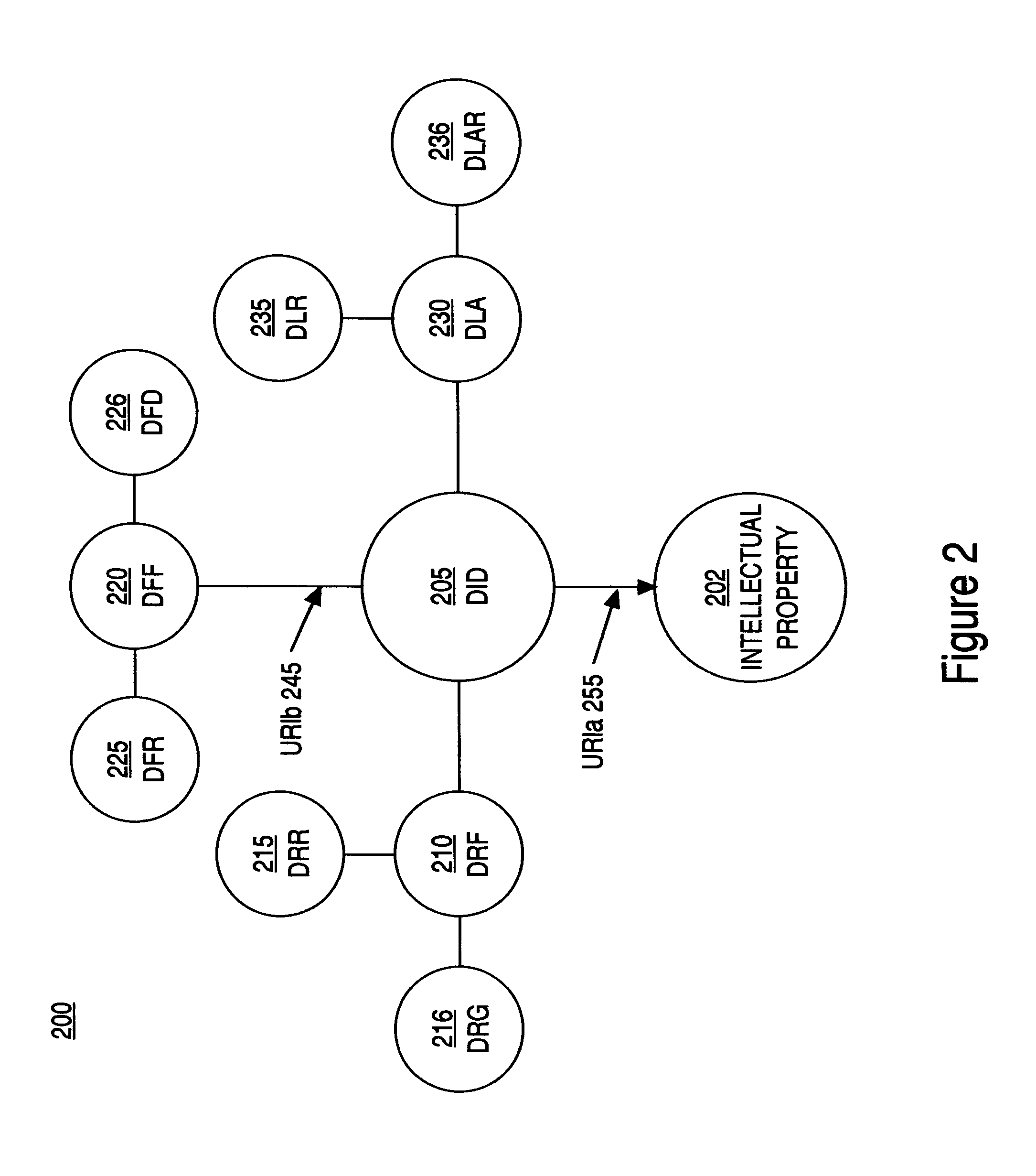

Digital license agreement

InactiveUS7031943B1Efficient and cost-effective assignmentEfficient allocationComputer security arrangementsCommerceIntellectual propertyLicense

A method and system for licensing intellectual properties. A user can acquire a license conveying rights in intellectual properties by accessing a designated site and making a digital license request. Terms and conditions that can be accepted by the user are then made available to the user in the form of a model digital license agreement. Agreement to the terms of the model digital license agreement by the user, and acceptance thereof by the Licensor, creates a digital license agreement that conveys the intellectual property rights defined in the digital license agreement. The final form of the digital license agreement, after agreement thereto by the Licensor and the user, creates a digital license agreement representation that is a digital representation of the terms and conditions that define the intellectual property rights conveyed.

Owner:CISCO TECH INC

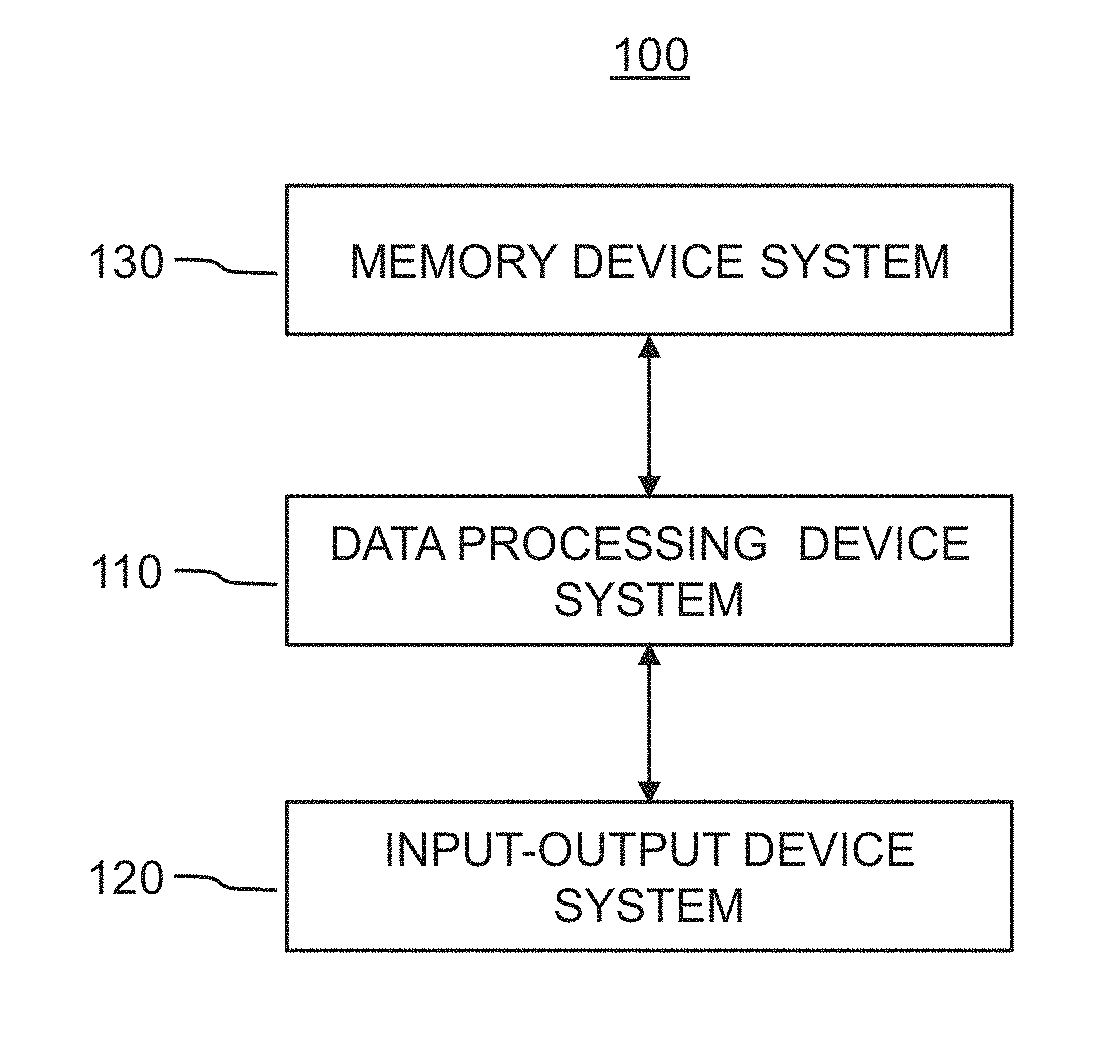

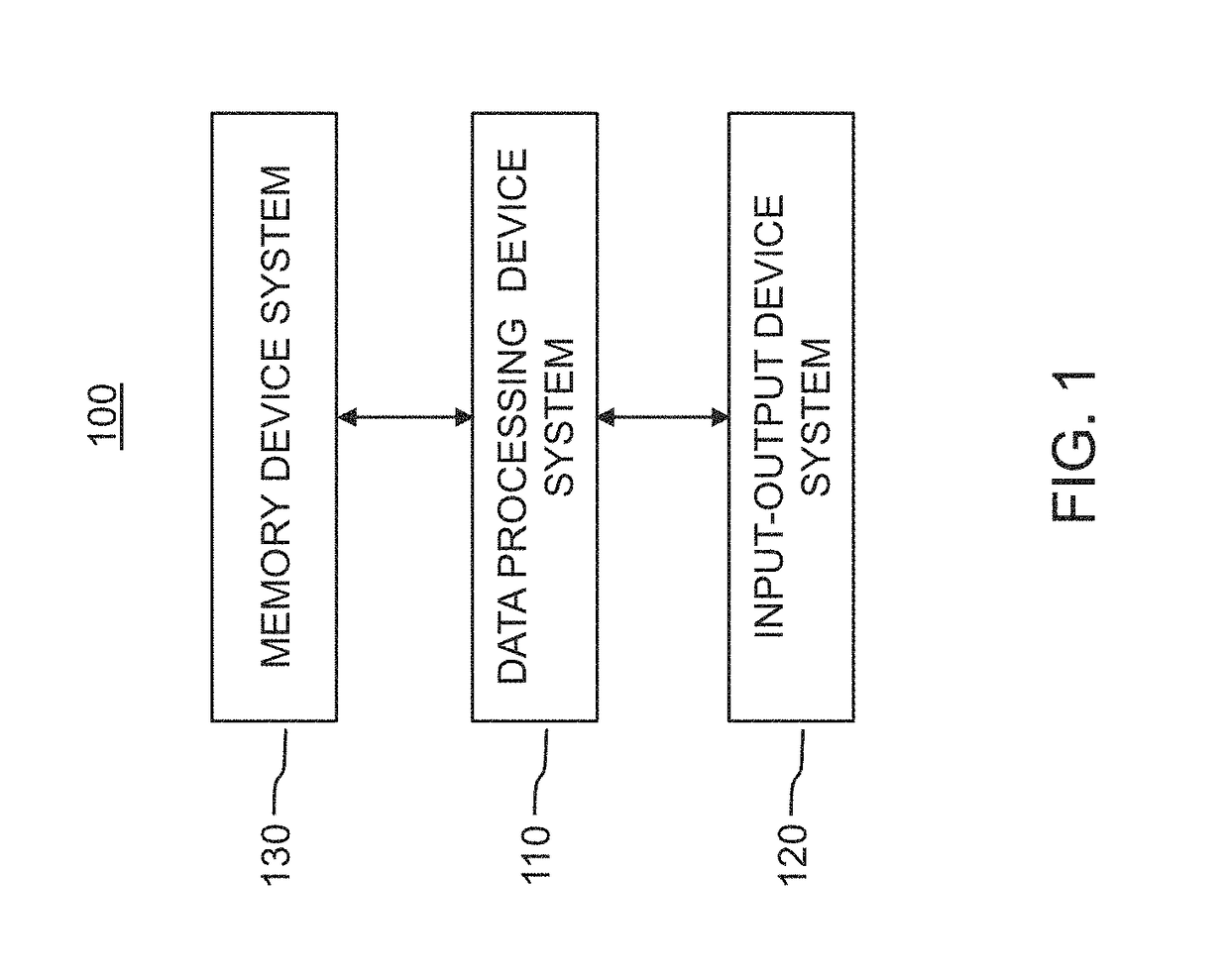

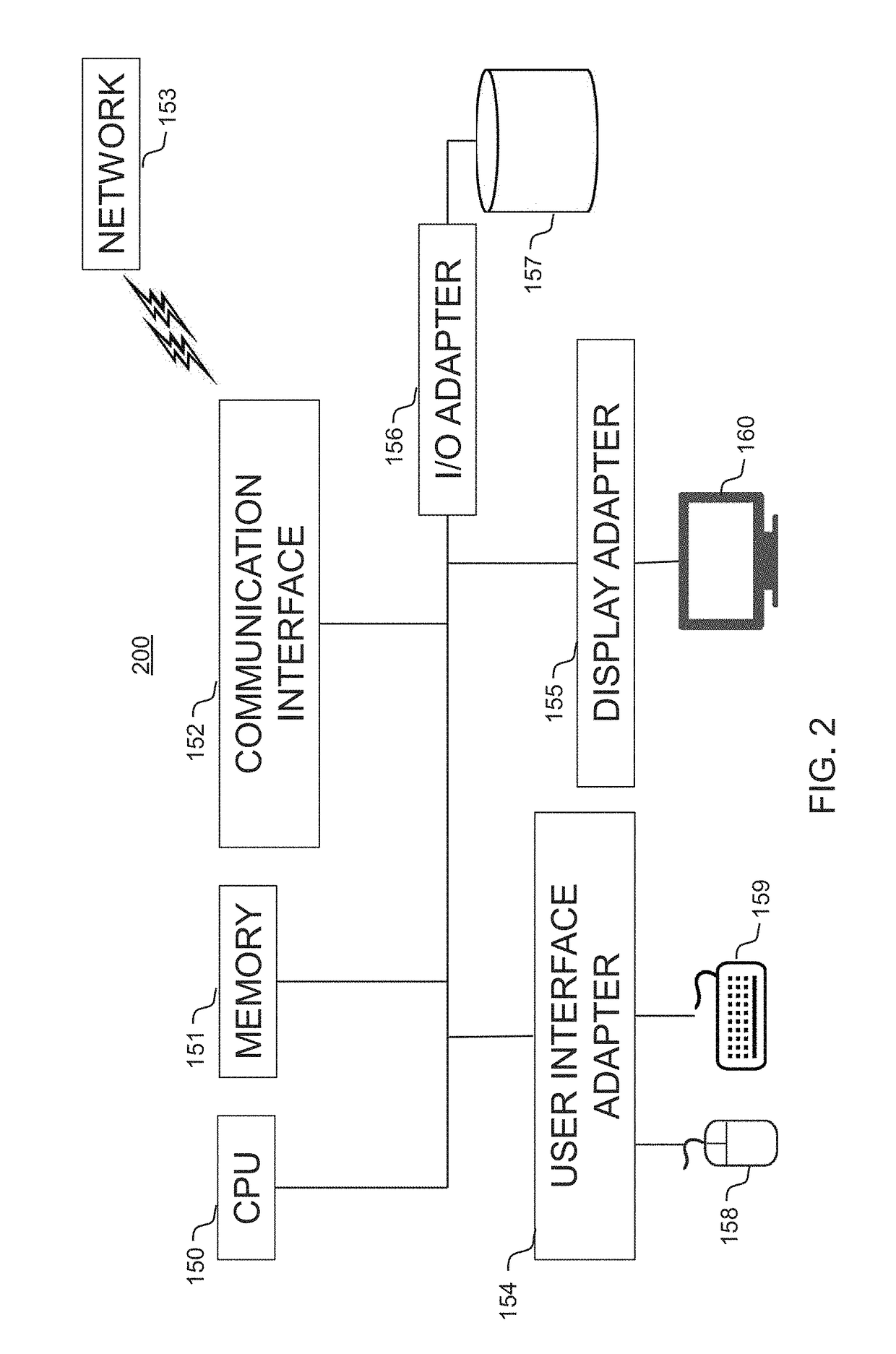

Self regulating transaction system and methods therefor

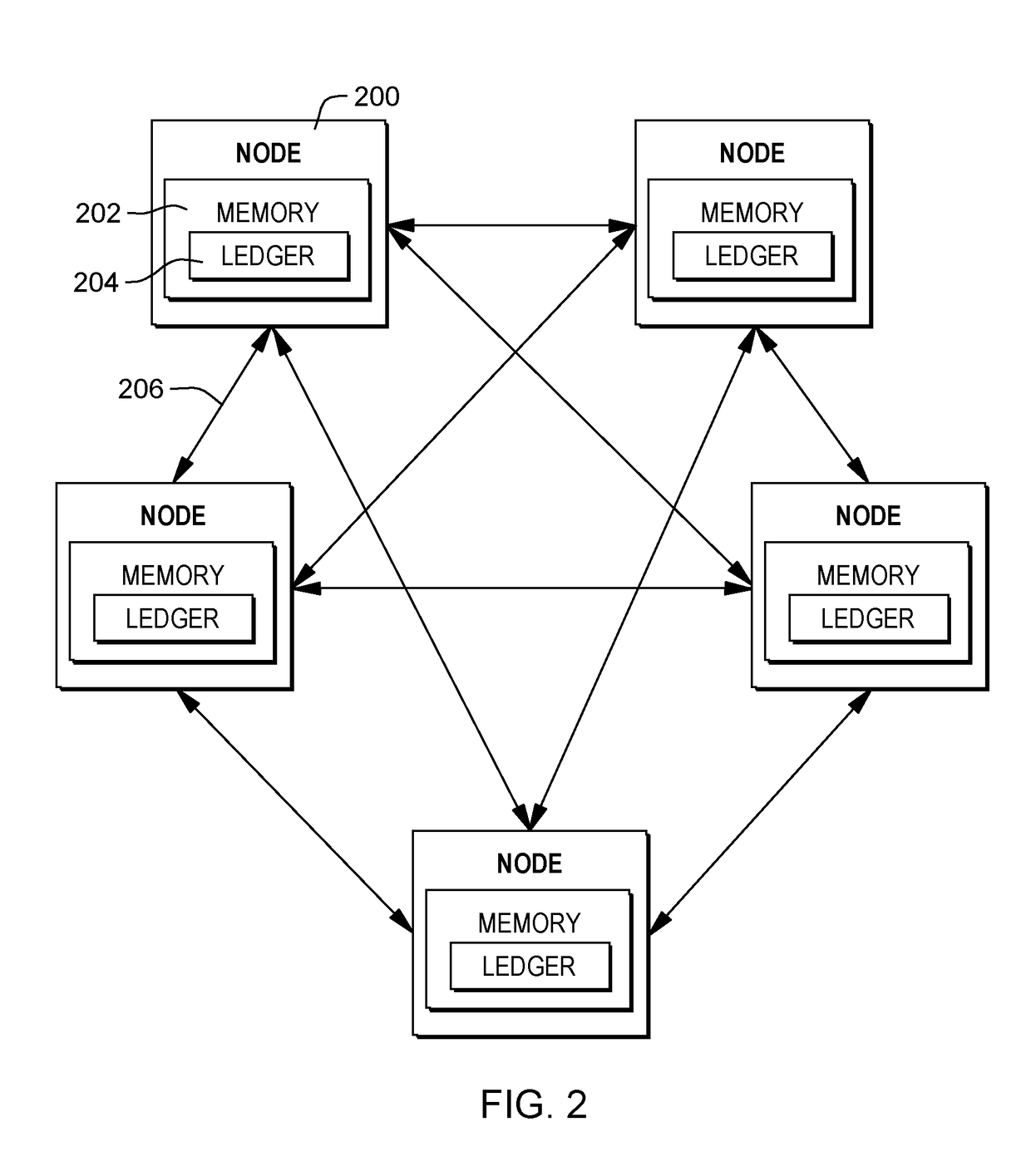

ActiveUS20180308134A1Reduce storage requirementsEfficient searchAdvertisementsPayment architectureReal-time computingData processing

A first processor-accessible memory device system and a second processor-accessible memory device system of a self-regulating transaction system may each store a respective local copy of one or more transaction ledgers that record transactions. A first data processing device system may be configured to generate a transaction information block associated with a particular market channel, store it in the local copy of a transaction ledger associated with the particular market channel stored in the first processor-accessible memory device system, and transmit it to a second data processing device system over a communications network for storage in the local copy of the transaction ledger associated with the particular market channel stored in the second processor-accessible memory device system.

Owner:KOCHAVA

Dynamically providing a third-party checkout option

Methods for facilitating financial transactions include facilitating or otherwise increasing the ease and speed of checkout processes. In particular, one or more implementations comprise an e-commerce payment facilitator that acts as an intermediary between a commerce application and a payment gateway. The e-commerce payment facilitator can provide stored payment information to a commerce application based on a few simple selections by a user. This allows a user to easily and securely complete commerce transactions, which simplifies the user's checkout experience and reduces barriers to purchase. Furthermore, the e-commerce payment facilitator can pass payment details to the commerce application's payment gateway. In addition to the foregoing, methods involve dynamically and intelligently providing a user the option of using payment information stored by the network application.

Owner:META PLATFORMS INC

Method and system for securing a third party payment electronic transaction

InactiveUS8290876B1Improve securityReduce fraudPoint-of-sale network systemsComputer securityThird party

Owner:SDP DEV

Data Verification Using Access Device

ActiveUS20150319161A1Safe wayReduce transactionDigital data processing detailsMultiple digital computer combinationsSource Data VerificationTransaction data

An embodiment of the invention is directed to a method comprising receiving, at a server computer, information for a portable device that includes a mobile device identifier and storing, by the server computer, the information for the portable device that includes the mobile device identifier in a database associated with the server computer. The method further comprising receiving, by the server computer, transaction data from an access device for a transaction conducted at the access device, determining, by the server computer, from the transaction data that the transaction is associated with the portable device, determining, by the server computer, a location of the access device, determining, by the server computer, a location of a mobile device associated with the mobile device identifier, determining, by the server computer, that the location of the mobile device matches the location of the access device, and marking, by the server computer, the stored information for the portable device as authentication verified.

Owner:VISA INT SERVICE ASSOC

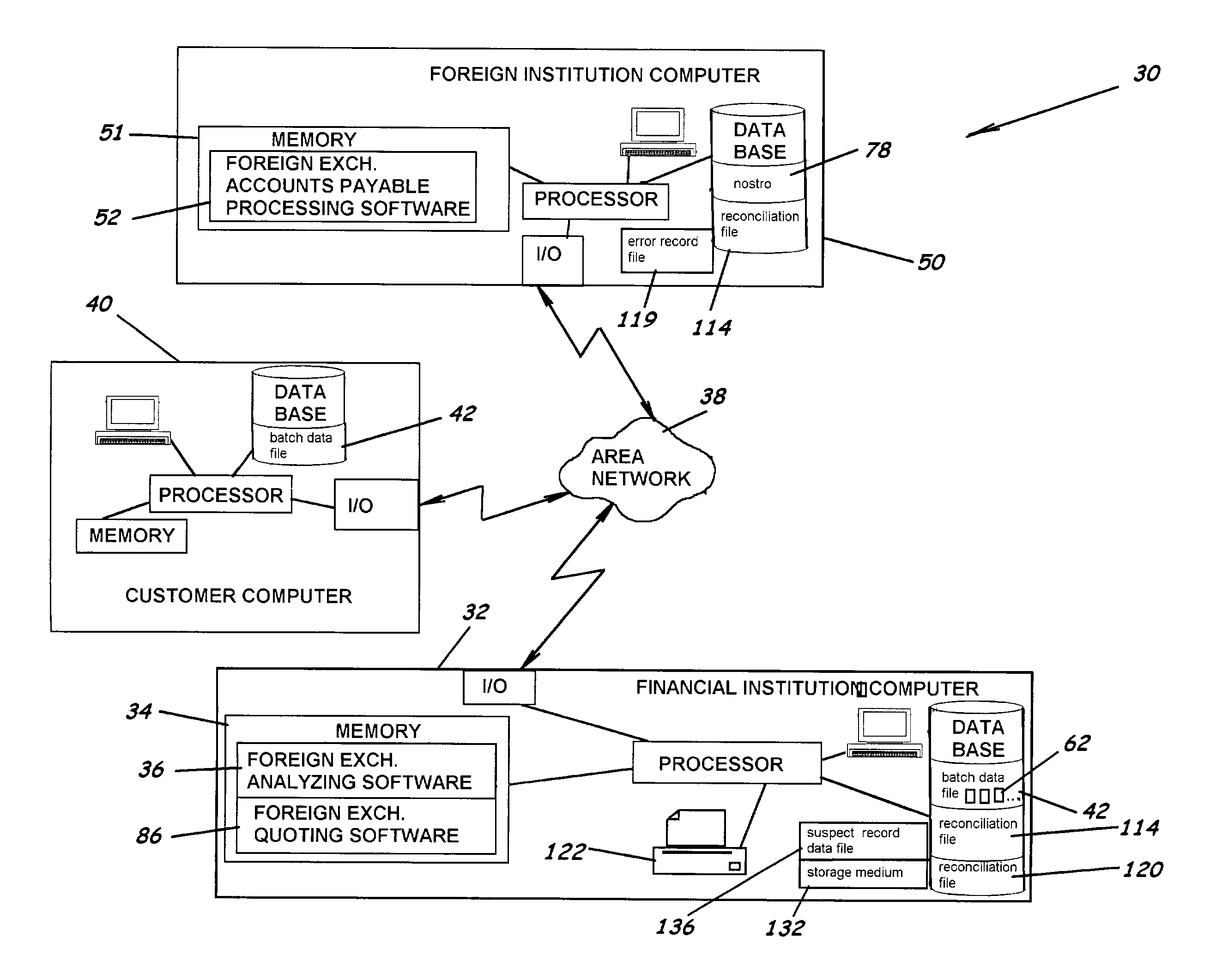

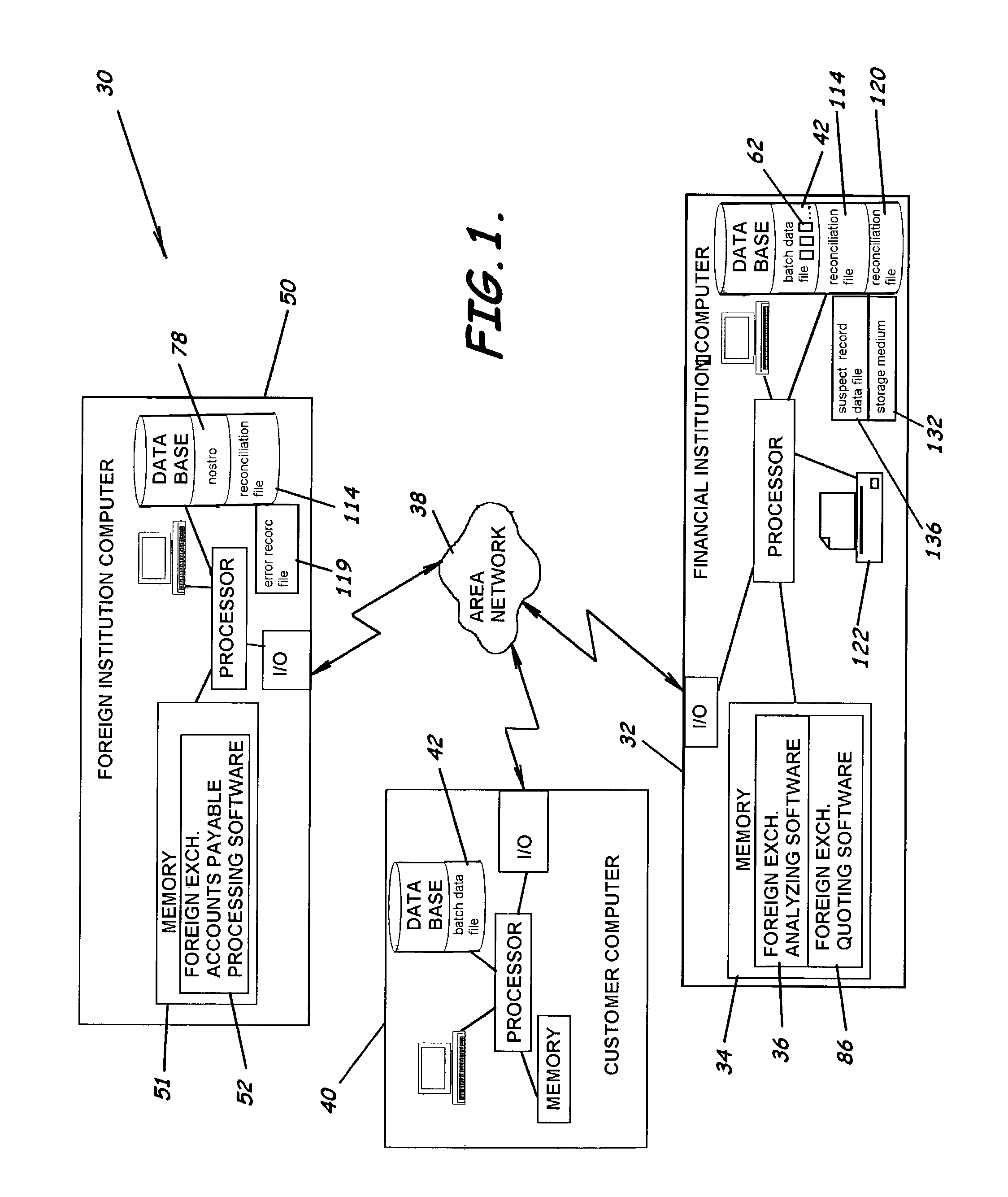

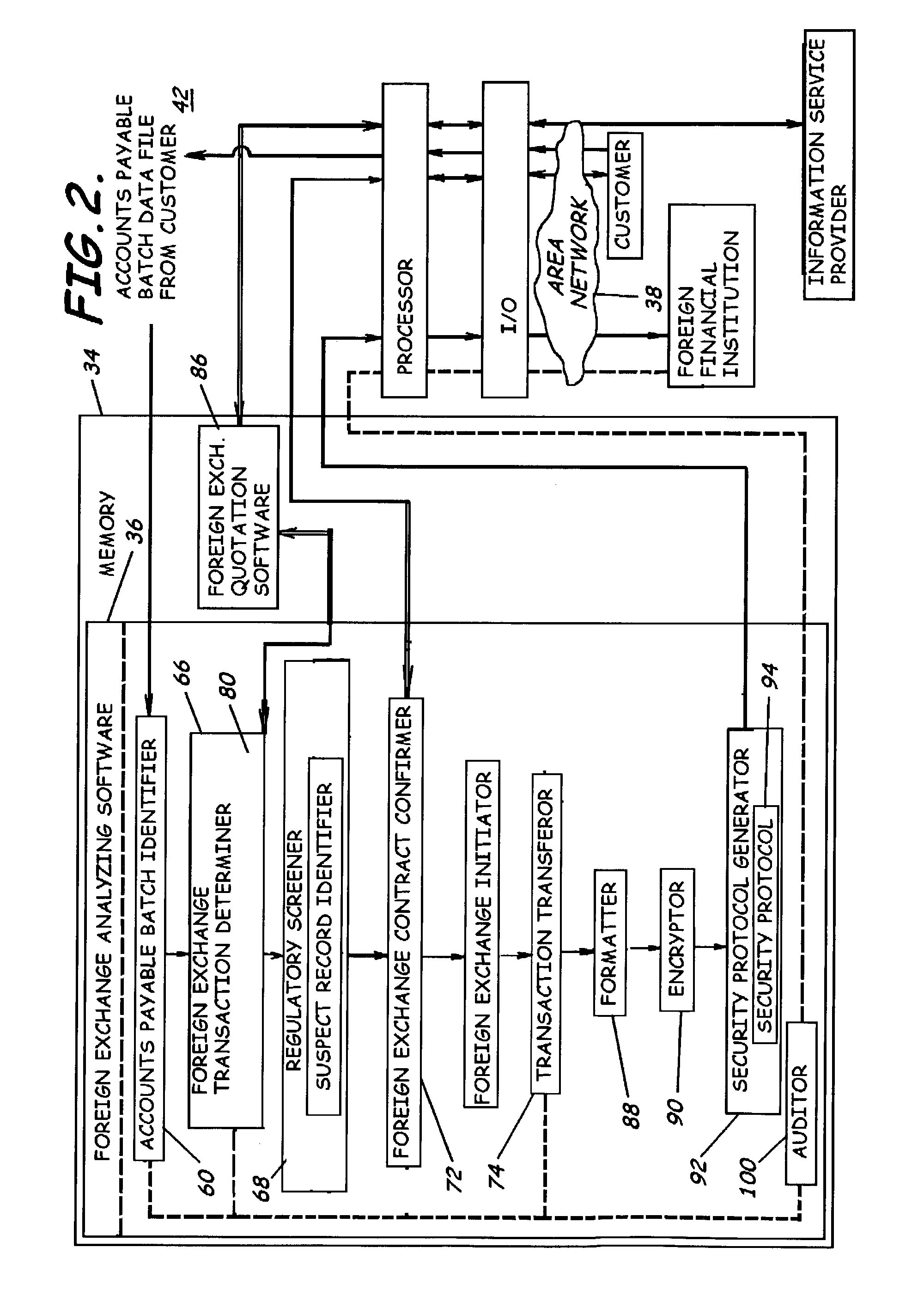

System to facilitate payments for a customer through a foreign bank, software, business methods, and other related methods

InactiveUS7689483B2Speed up the flowReduce exchangeComplete banking machinesFinanceArea networkAccounts payable

A system for facilitating payment of accounts payables from a foreign financial institution for a customer of a domestic financial institution, software, and methods are provided. The system includes a first financial institution computer positioned at a domestic financial institution site to define a domestic financial institution server, having memory associated therewith, and foreign exchange analyzing software stored in the memory of the domestic financial institution server to analyze a foreign exchange transaction. The system also includes an area network in communication with the server, and a second customer computer in communication with the area network, positioned remote from the server at a customer site, and positioned to transmit an accounts payable batch data file having a plurality of accounts payable to the foreign exchange analyzing software stored on the server.

Owner:SOUTHWEST BANK OF TEXAS N A

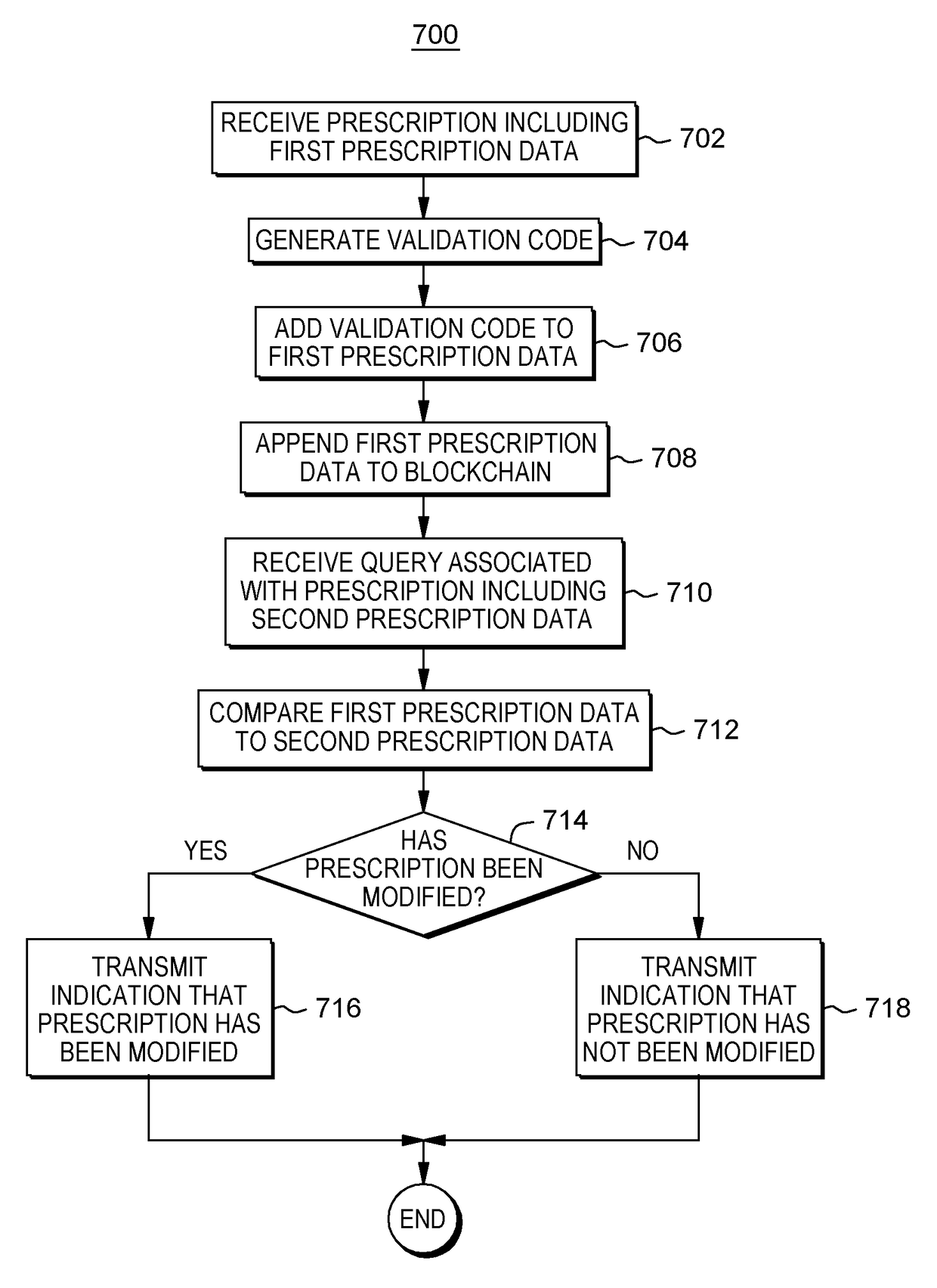

Detecting medical fraud and medical misuse using a shared virtual ledger

ActiveUS20180121620A1Reducing fraudulent transactionReduce transactionDigital data information retrievalDrug and medicationsComputer sciencePrescription data

A system and method of detecting medical fraud using blockchains including receiving a prescription comprising first prescription data from a prescription entry device associated with an prescribing entity, generating a validation code for the prescription based on the first prescription data, adding the validation code to the first prescription data, appending the first prescription data including the validation code to a blockchain, and receiving a query associated with the prescription from a prescription verification device associated with a prescription dispensing entity. The query includes second prescription data. The method further includes comparing the first prescription data to the second prescription data, for example, using pixel comparison, determining based on the comparison that the prescription has been modified, and transmitting to the prescription verification device an indication that the prescription has been modified.

Owner:MERATIVE US LP

Data security system using mobile communications device

ActiveUS20150019424A1Reducing fraudulent transactionImprove account securityFinancePayment architecturePaymentSpecific time

Embodiments of the invention provide systems and methods to unlock an account associated with a user for a limited period of time to enable the user conduct a transaction using funds from that account. In one embodiment of the invention, the user may select options relating to the transaction using a payment menu provided at a mobile communications device associated with the user. A notification message is received at the mobile communications device informing the user that the account is unlocked for a certain period of time and for a certain amount. After the transaction is complete, the user is notified and the account is locked again.

Owner:VISA INT SERVICE ASSOC

Data-maintenance method of distributed shared memory system

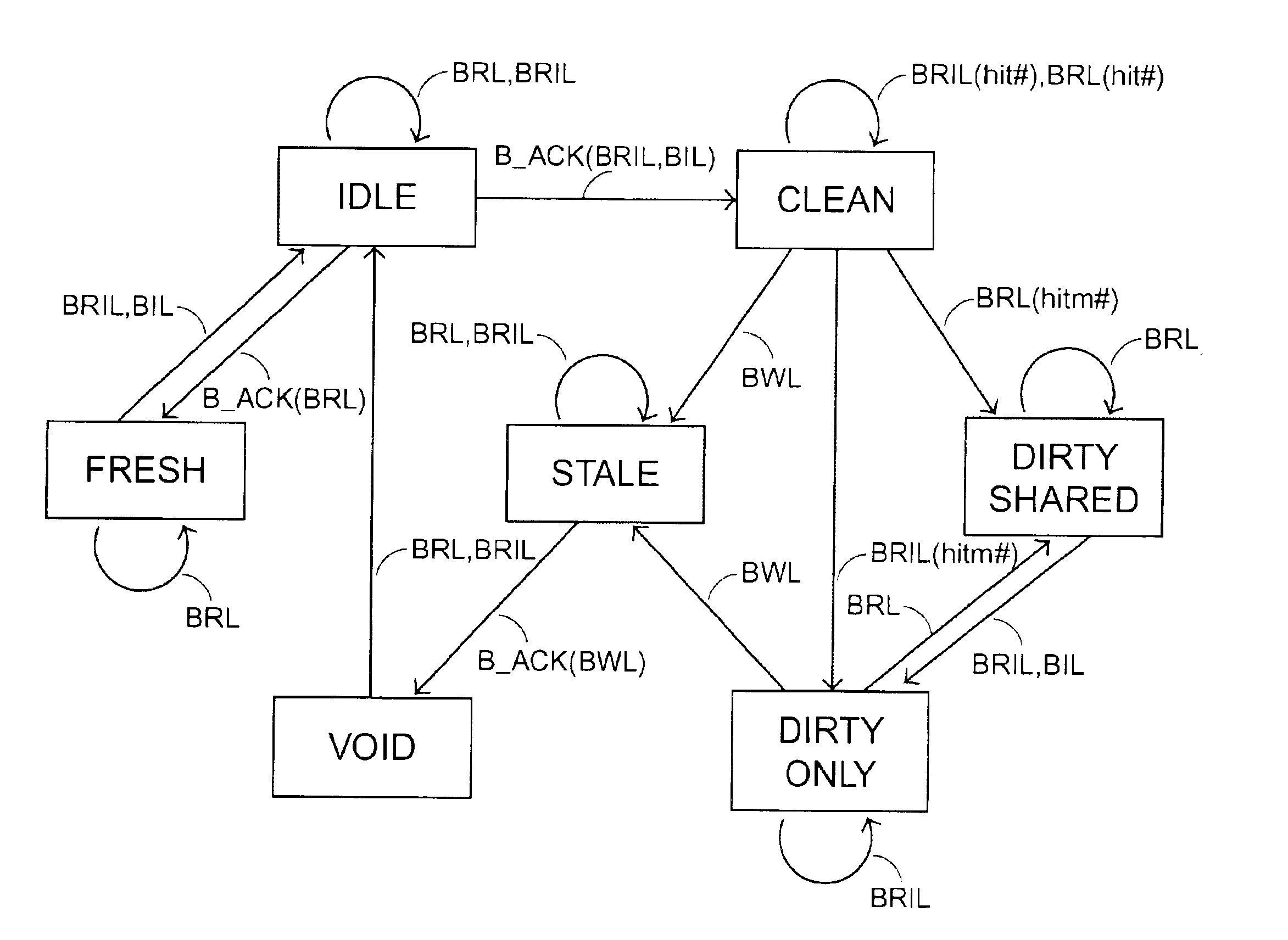

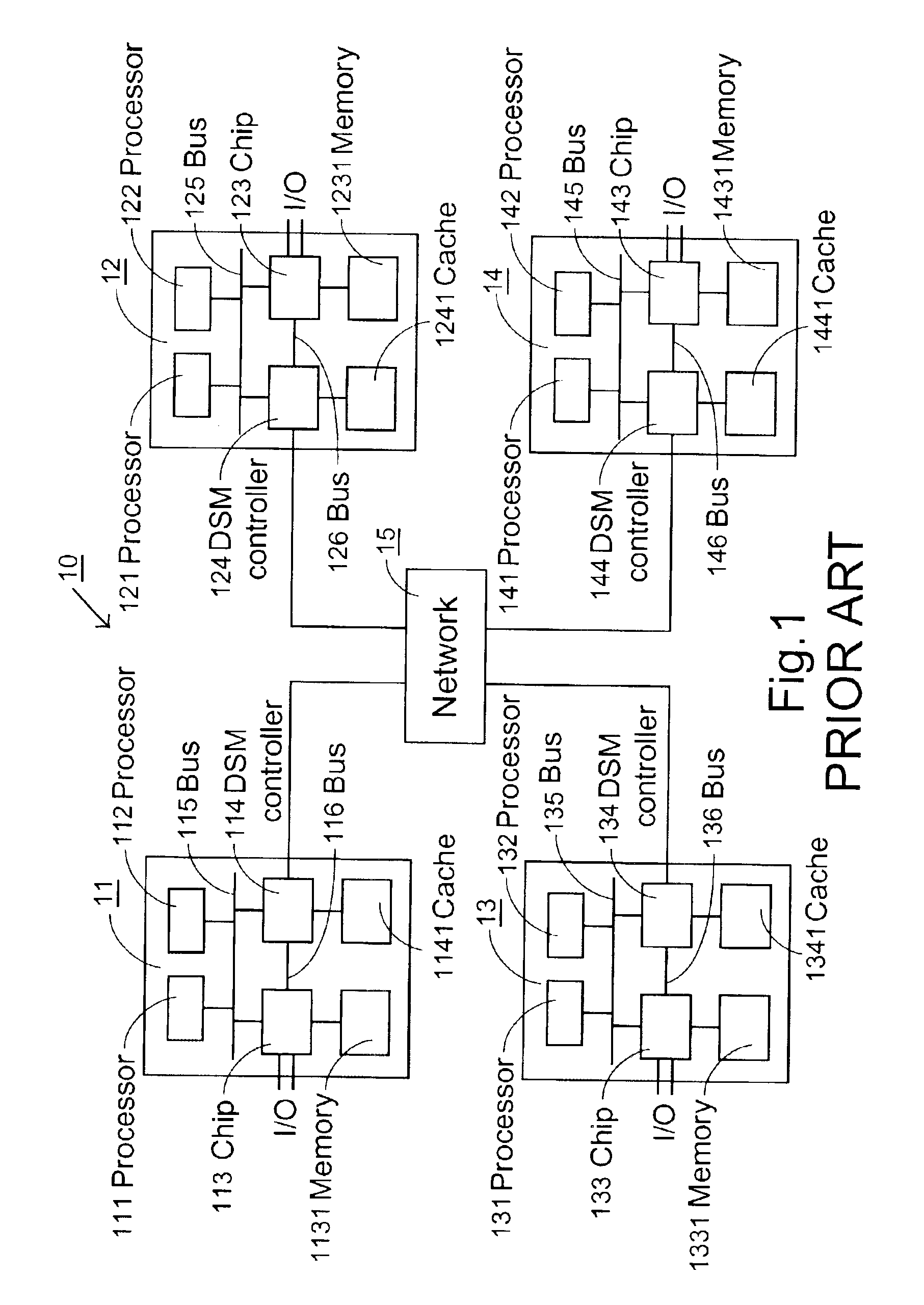

ActiveUS6931496B2Reduced transaction requestReduce transactionMemory architecture accessing/allocationMemory adressing/allocation/relocationLocal memoriesDistributed shared memory

A distributed shared memory (DSM) system includes at least a first and a second nodes. The first node includes an external cache for storing a data from a local memory of the second node and at least two processors optionally accessing the data from the external cache. Whether the data has been modified into a modified data by a first certain one of the at least two processors is first determined. If positive, whether a second certain one of the at least two processors is allowed to share the modified data is further determined. If the second certain processor is allowed to share the modified data, it may directly request the modified data from the first certain processor via a bus inside the first node.

Owner:VIA TECH INC

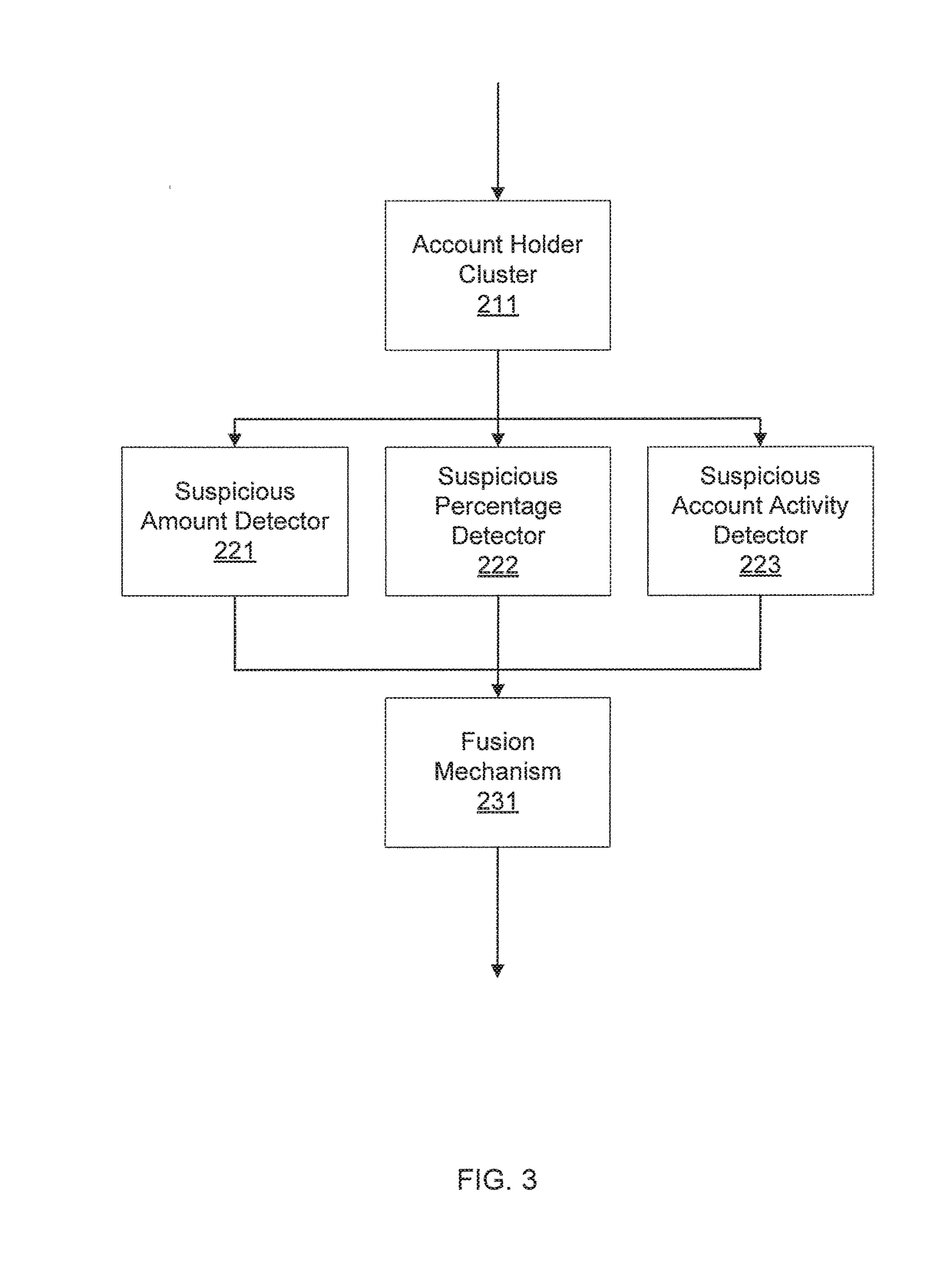

Financial fraud detection using user group behavior analysis

InactiveUS20180365696A1Reduce fraudMitigate suspicious transactionCharacter and pattern recognitionData switching networksCluster algorithmSuspicious behaviour

Systems and methods for mitigating fraud in transactions including clustering account holders into groups with a cluster generator by jointly considering account activities as features in a clustering algorithm such that account holders in each group have similar behavior according to analysis of the features in the clustering algorithm. In each group, a list of suspicious transactions is detected with a suspicious behavior detector by determining outlier transactions for a transaction type of interest relative to transactions of each account holder in a group. An alert is generated and sent to users with a fraud suspicion response system to mitigate the suspicious transactions.

Owner:NEC LAB AMERICA

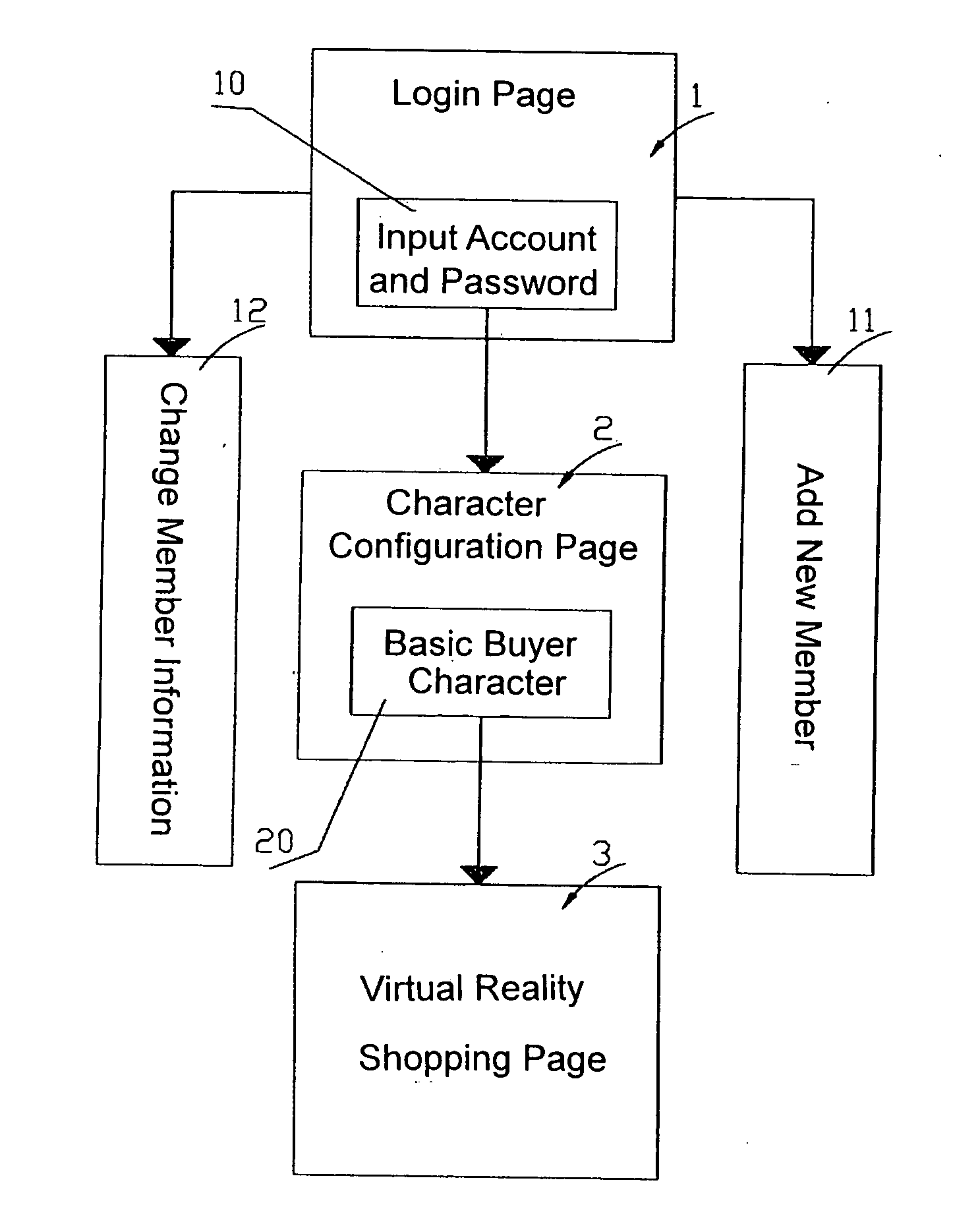

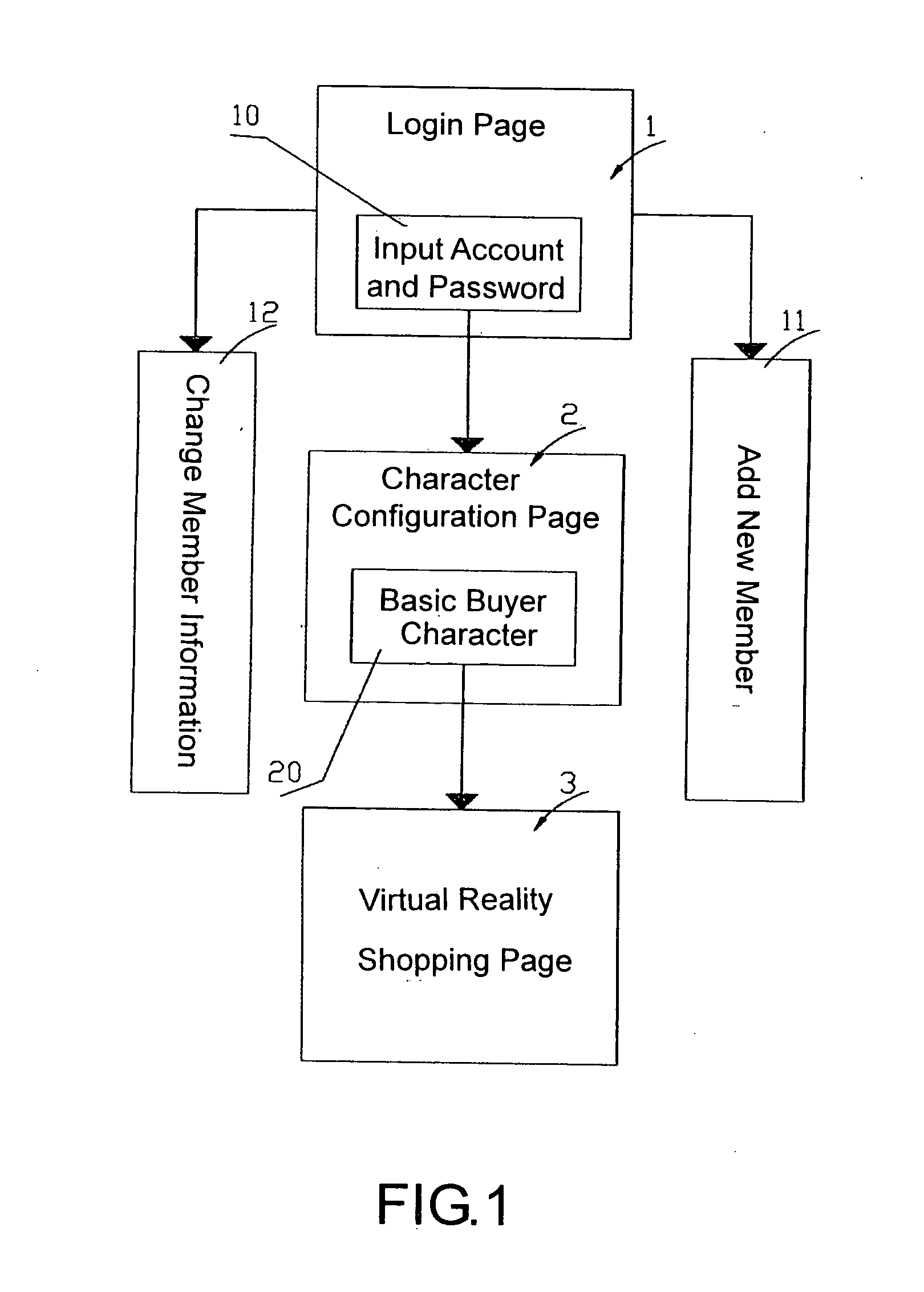

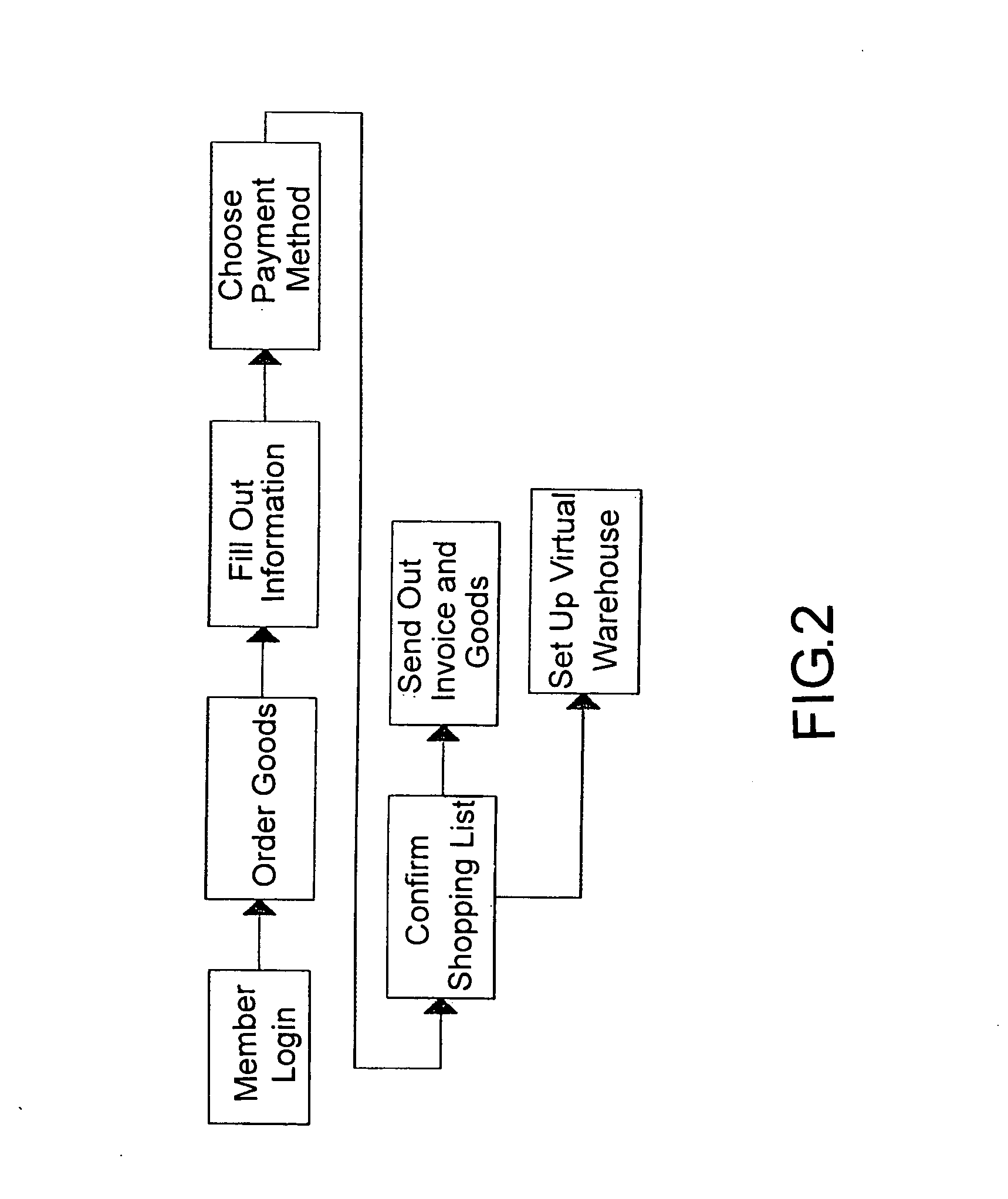

Virtual reality shopping system

A virtual reality shopping system is composed of a login page, a character configuration and selection page, and a virtual reality shopping page. The login page is configured as a system for acknowledging or adding members. After a basic buyer character is chosen, the character configuration and selection page can provide a buyer for performing a modeling to the virtual character. The virtual reality shopping page is designed as a virtual reality three-dimensional shopping website enabling individual buyers to mutually interact by assembling virtual map files, according to the design of virtual reality map files and the interaction with a plurality of virtual characters in the map files. In addition, the virtual characters can fit on virtual clothes or accessories in advance, when performing an Internet transaction on the virtual reality shopping website.

Owner:ROYAL PLANET

Loyalty rewards direct payment and incentive method and system

InactiveUS20130151325A1Reduces tender process timeReduces of rewardMarketingDirect PaymentsComputer science

A method and system of facilitating and expediting a Transaction between a Merchant and a Patron of the Merchant is provided. In one embodiment of the invention, a Patron who has previously registered their loyalty account to receive Incentive Rewards for completing the Transaction and to allow the transfer of funds, utilizing an ACH Transaction, from their account to the Merchant's account, can use a single Personal Loyalty Device to expedite, pay for and complete the Transaction and receive Incentive Rewards. According to the invention, after receiving the loyalty account number and, optionally Authentication Information, the Merchant transmits that information and, optionally, Transaction information, to a Rewards Transaction Server who verifies the Transaction, determines Incentive Rewards, generates an Accept Code and sends it to the Merchant, whereupon the Transaction is completed. The Rewards Transaction Server also causes one or more ACH transactions to occur to transfer the funds.

Owner:POIDOMANI MARK +1

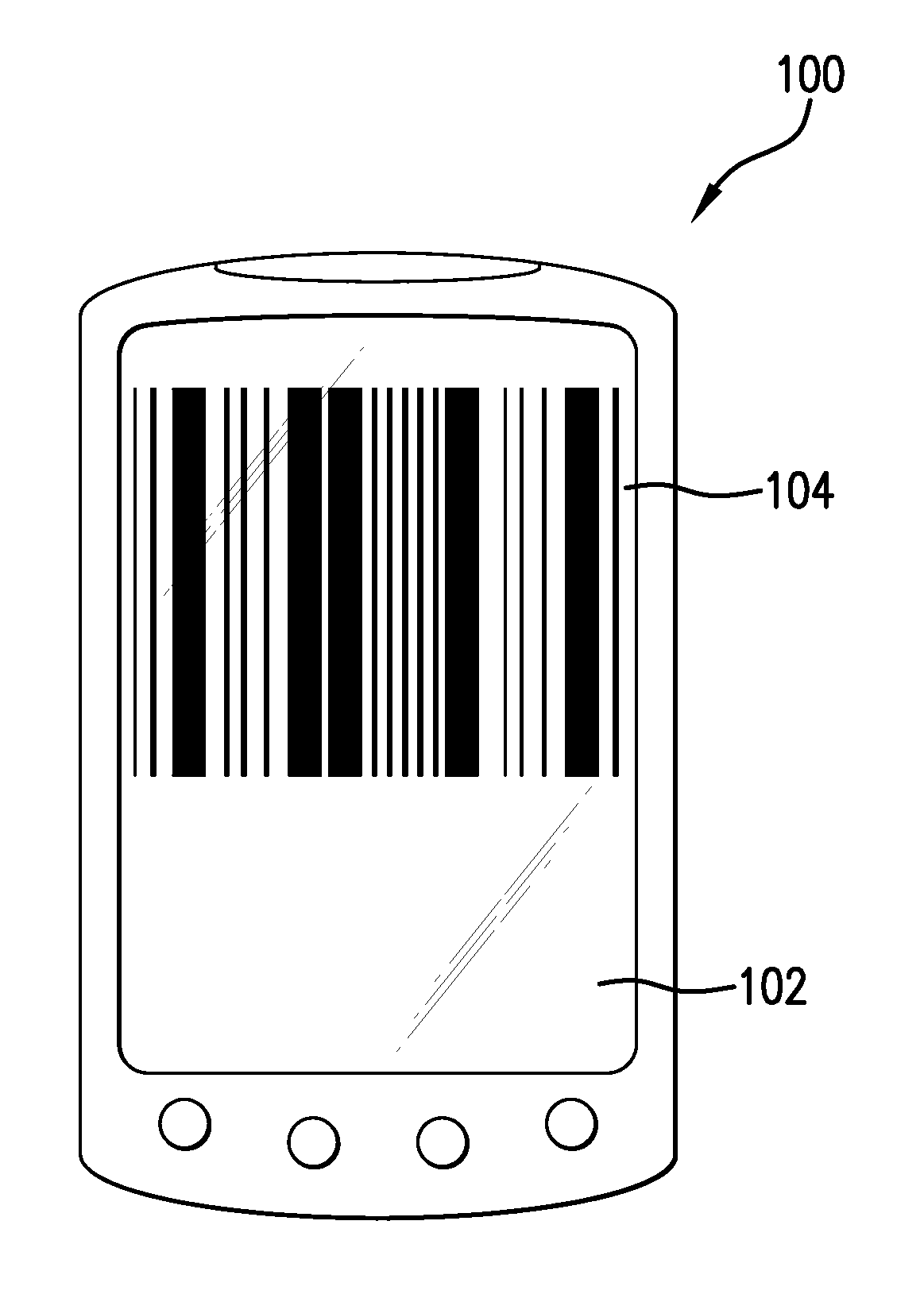

Financial card transaction security and processing methods

ActiveUS20140025518A1Reducing fraudulent transactionAvoiding high interchange feeHand manipulated computer devicesFinanceClosed loopFinancial transaction

Methods and systems for a secure financial transaction that can be processed through open loop or closed loop networks using electronically readable or visual data that is preferably provided or integrated into a financial card to determine network selection and card authentication and verification requirements.

Owner:VERITEC INCORPORATED

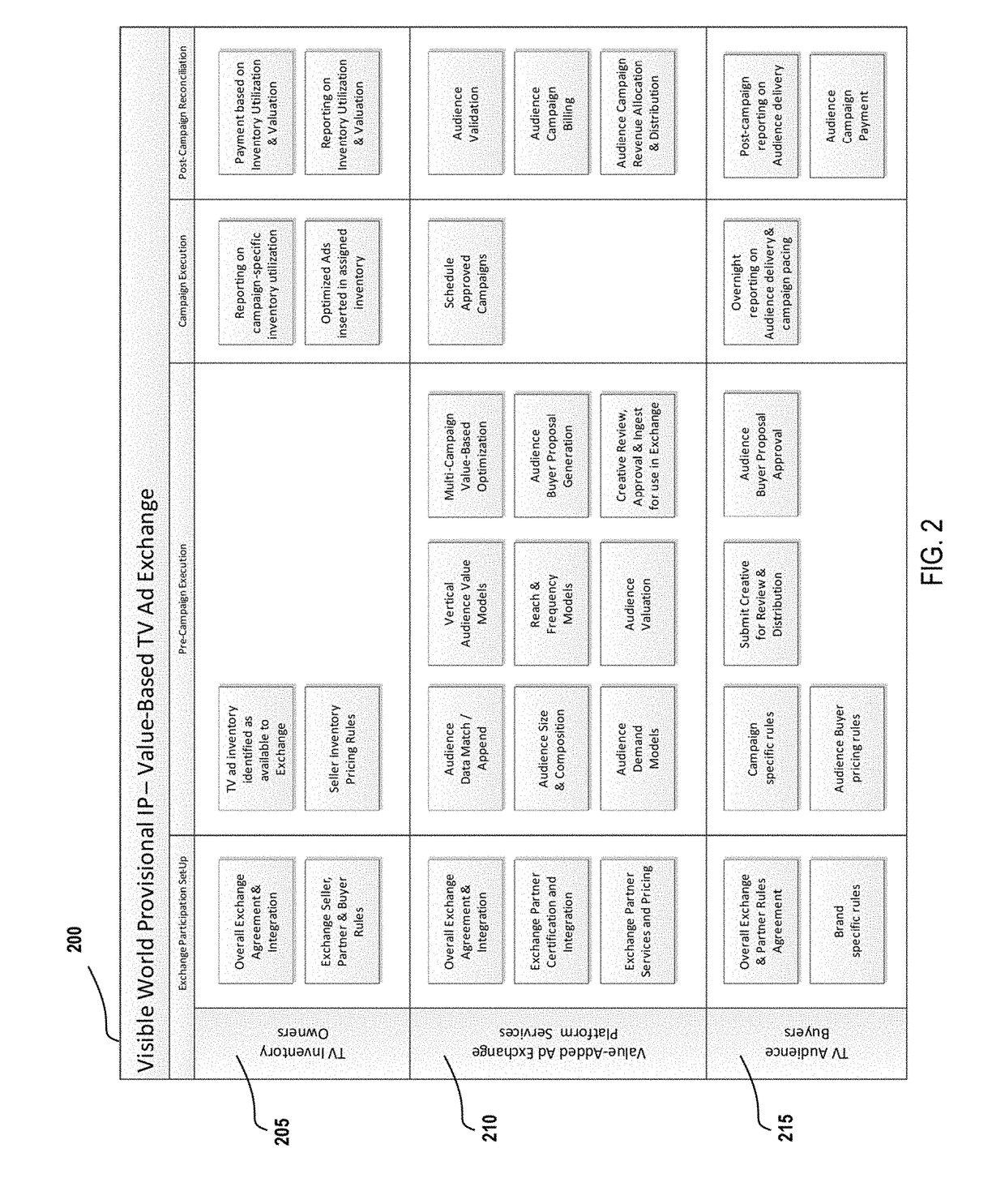

Value-based TV advertising audience exchange

ActiveUS20170195747A1Lower current transactionLower execution barrierSelective content distributionApplication softwareTrusted system

Systems, methods and computer-readable media for a decentralized application system that enables participating parties to automate the buying and selling of TV media units and / or aggregated TV and premium video audiences is described. The value-based TV / premium video media exchange application system allows the participants to interact with the system directly and / or automate transactions and execution between systems, while ensuring proper governance over each participants own rules and economics associated with the transactions, as well as individual campaign constraints and requirements. The decentralized application system significantly lowers current transaction and execution barriers, timing and costs, while providing a highly accountable and trusted system across all of the exchange participants.

Owner:FREEWHEEL MEDIA

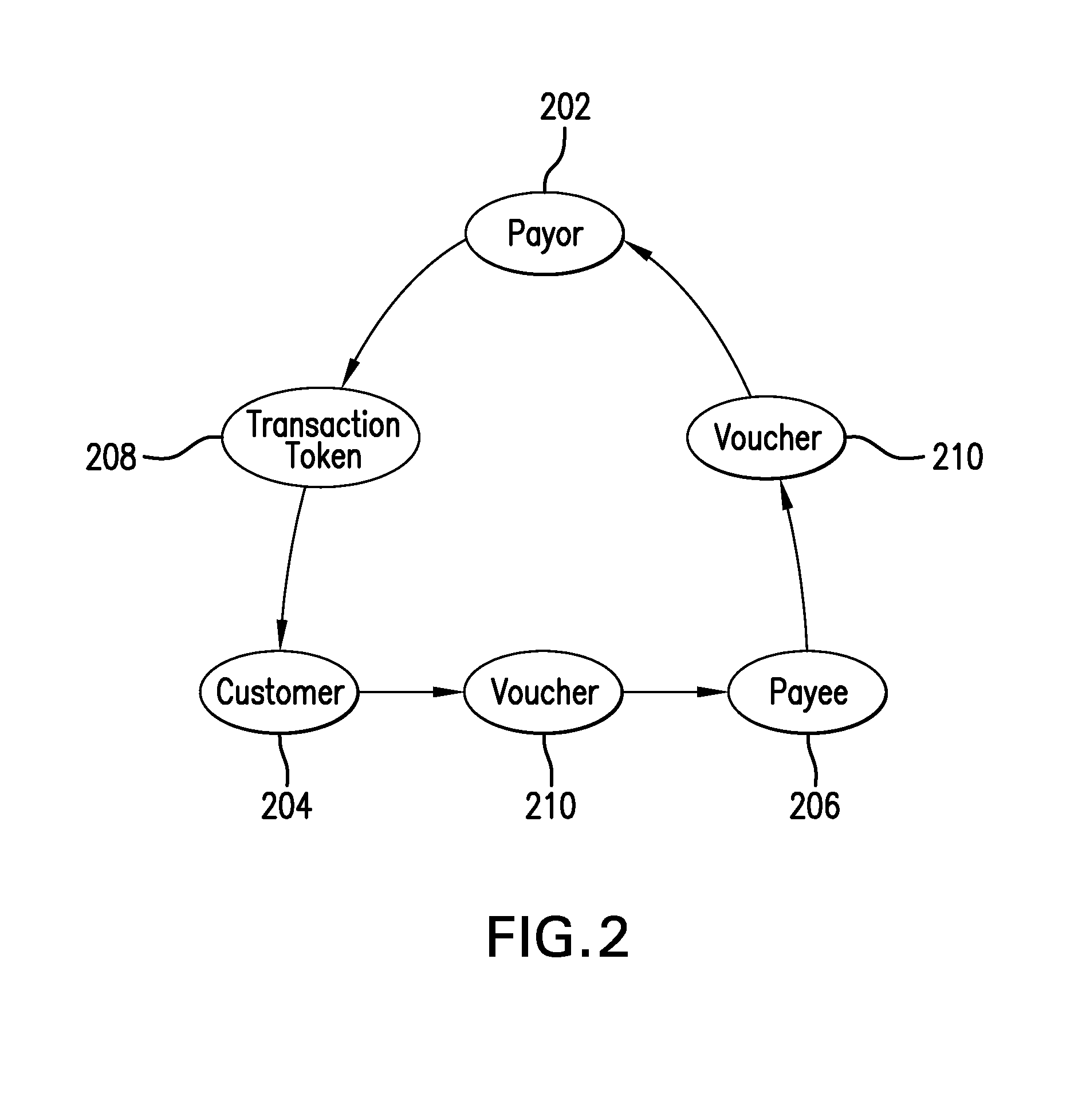

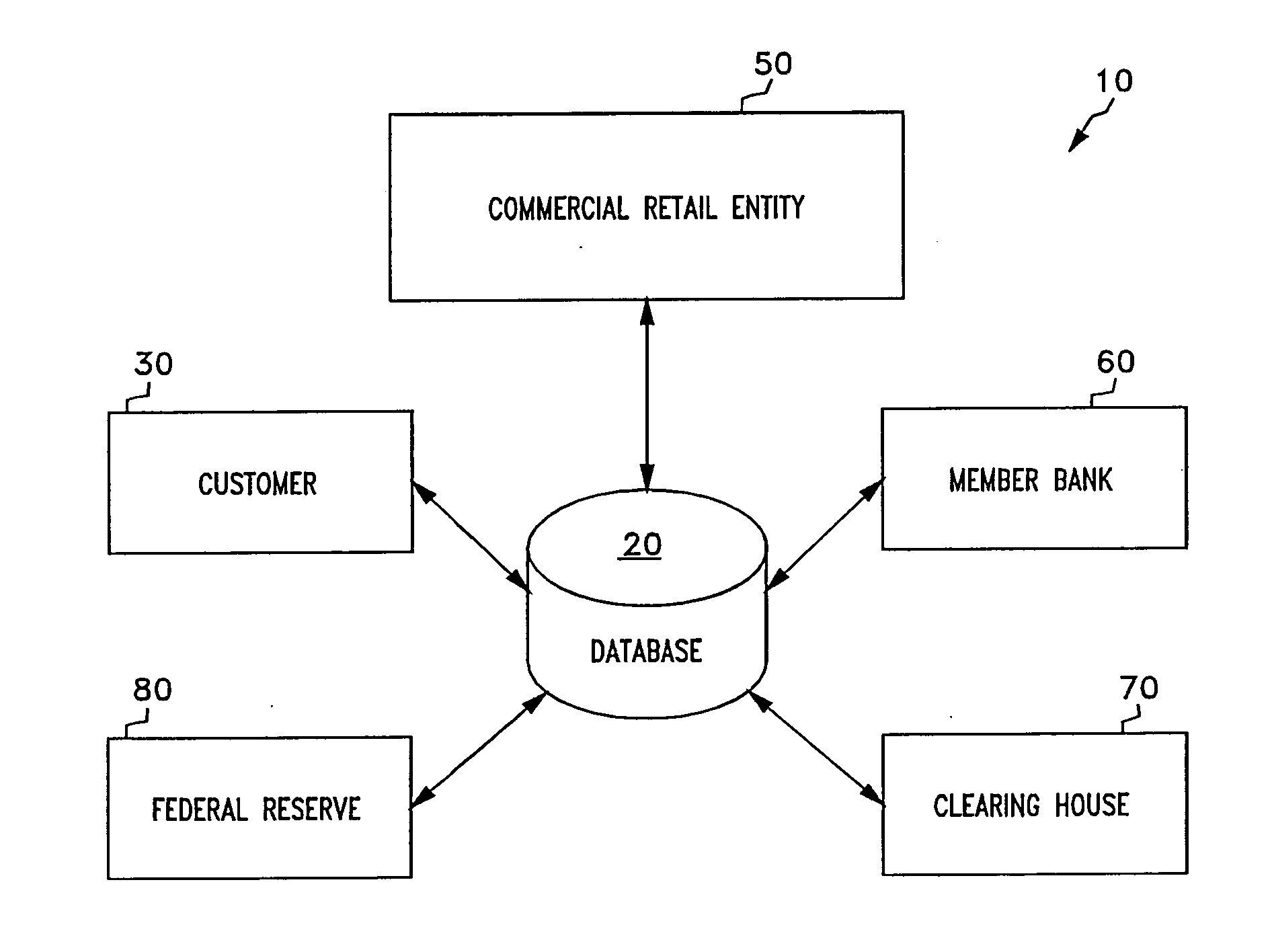

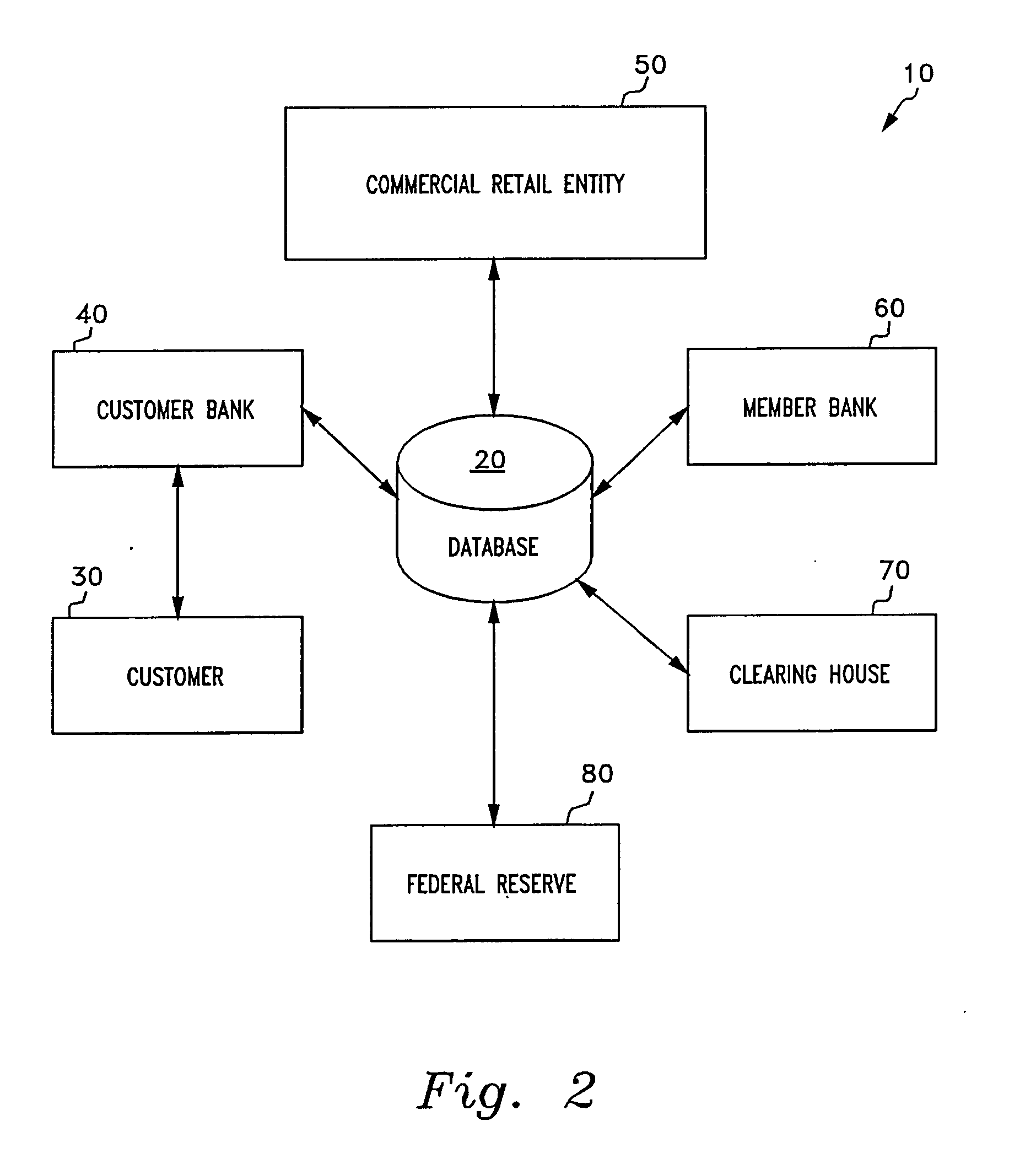

Universal positive pay match, authentication, authorization, settlement and clearing system

InactiveUS20130117183A1Reduce transactionKeep full controlFinanceCredit schemesFinancial transactionFinancial trading

A Universal Positive Pay Database (UPPD) method, system and / or computer useable medium to reduce financial transaction fraud. A UPPD database is configured to store thereon transaction records associated with financial transactions corresponding to customers of the UPPD database. A particular financial transaction is initiated between a payer and a payee by providing parameters associated with the financial transaction to the UPPD database. An issue Vile is provided to the UPPD database that includes parameters associated with the particular financial transaction. A correspondence determination is made between the financial transaction parameters from the Issue File and the financial transaction parameters provided to the UPPD database at every point along the financial transaction clearing process. The customer, payer, payee, payee bank, drawee bank, and banking institutions intermediate the payee bank and the drawee bank are able to access the correspondence determination at every point along the financial transaction clearing process.

Owner:BOZEMAN FINANCIAL

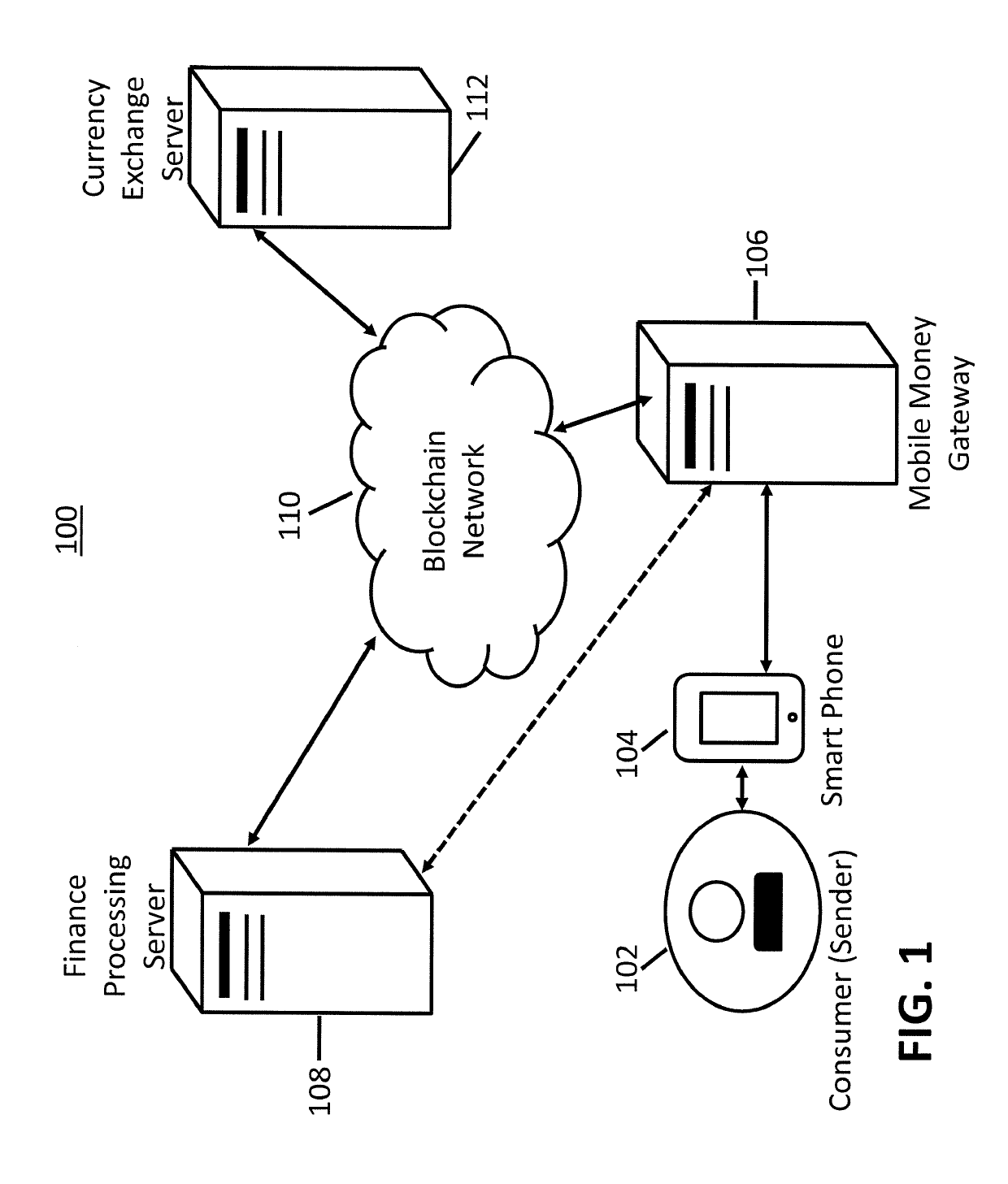

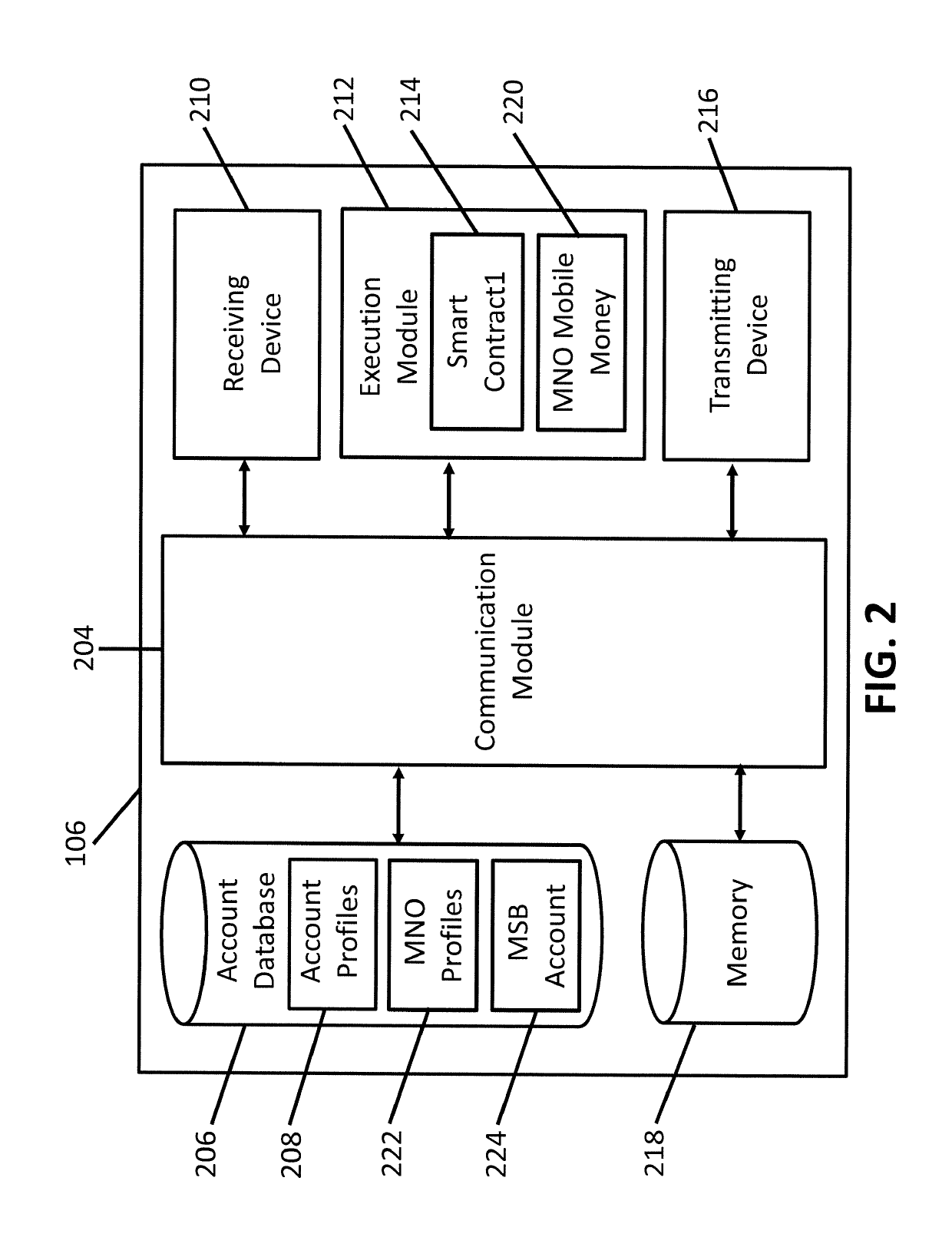

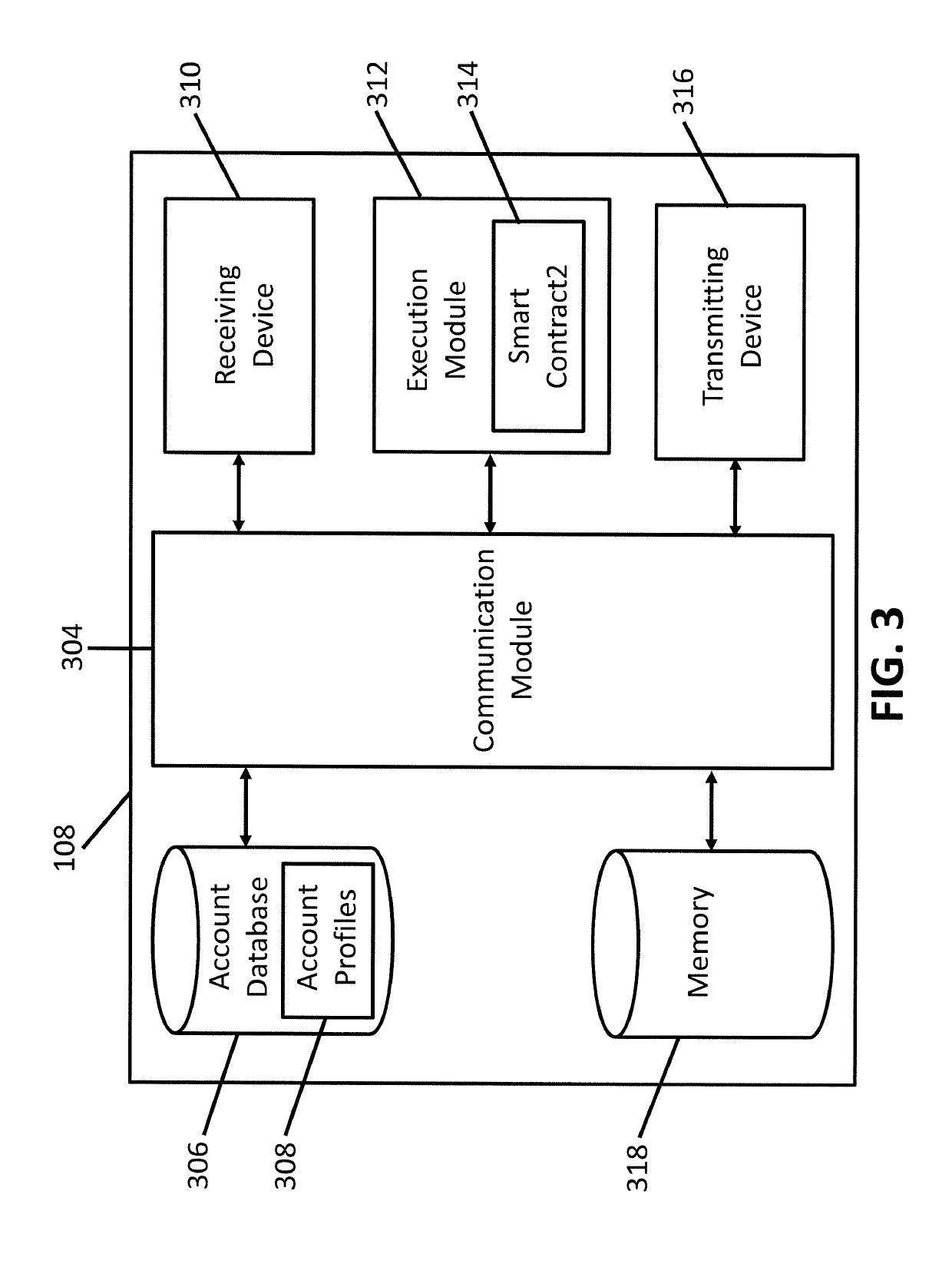

Methodology and system for a blockchain-based mobile money gateway

PendingUS20190180274A1Reduce global remittance transaction feeLow costCurrency conversionPayments involving neutral partySmart contractComputer science

This invention is directed to a methodology and system for a blockchain-based mobile money gateway for facilitating fast and secure blockchain-based funds transfer. According to an embodiment of the present invention, smart contracts may be triggered to execute in response to a consumer requesting remittance and the finance institution, which may or may not be on the blockchain network, verifying consumer information, such as funds availability. This successful execution may trigger another smart contract to execute the currency exchange on a relevant currency exchange server, also on the blockchain network. The successful currency exchange may then trigger the execution of another smart contract to transfer the exchanged funds to the blockchain mobile money gateway, also a participant on the blockchain network. Once the funds are transferred to the blockchain mobile money gateway, the funds may then be pushed to the mobile money account of the receiver.

Owner:GLOBAL MOBILE FINANCE INC

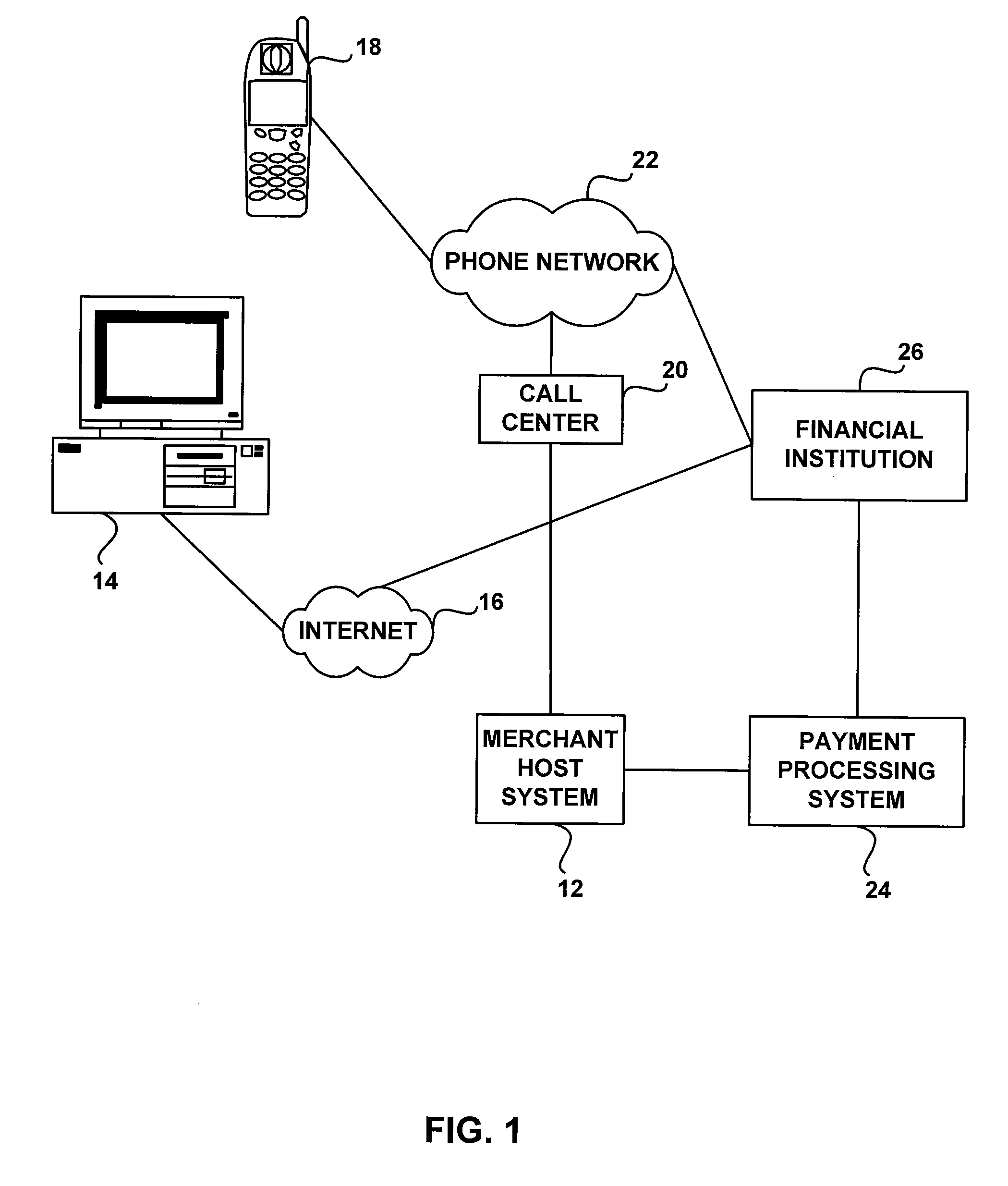

Authentication system for financial transactions

ActiveUS20080178258A1Reduce transactionReduce riskDigital data processing detailsUser identity/authority verificationTransaction dataComputerized system

In one embodiment, a computerized method for authenticating a financial account when making a purchase utilizes a merchant computer system which receives a purchase request from an account holder. The merchant computer system prepares transaction data that comprises account holder account data and authentication information. The transaction data is transmitted to a financial institution of the account holder. Subsequently, the merchant computer system receives the authentication information that was obtained by the account holder from the financial institution. The authentication information from the account holder is analyzed and future transactions are authenticated if the authentication information is correct.

Owner:FIRST DATA

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com