Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

344results about How to "Reduce transaction costs" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

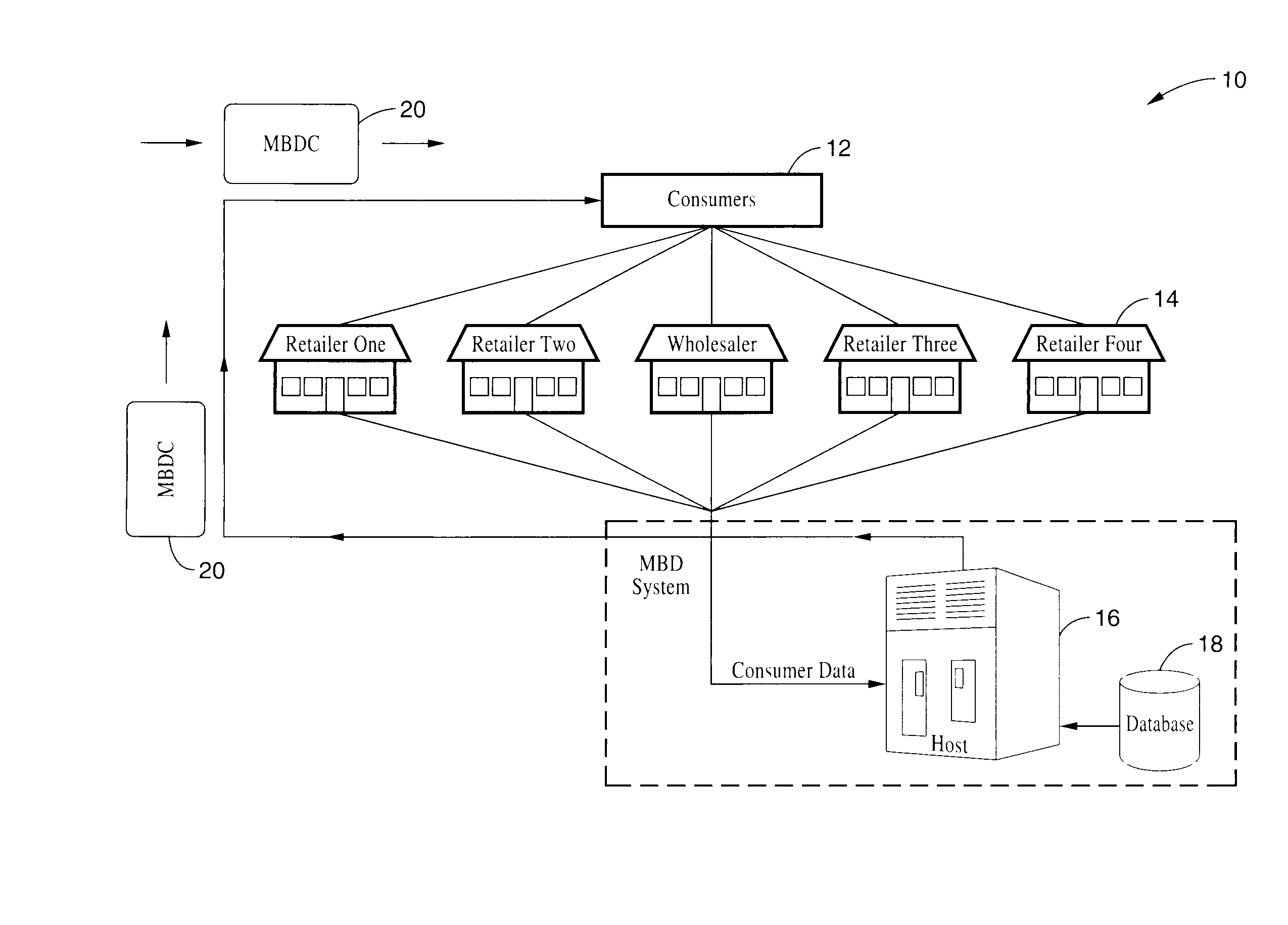

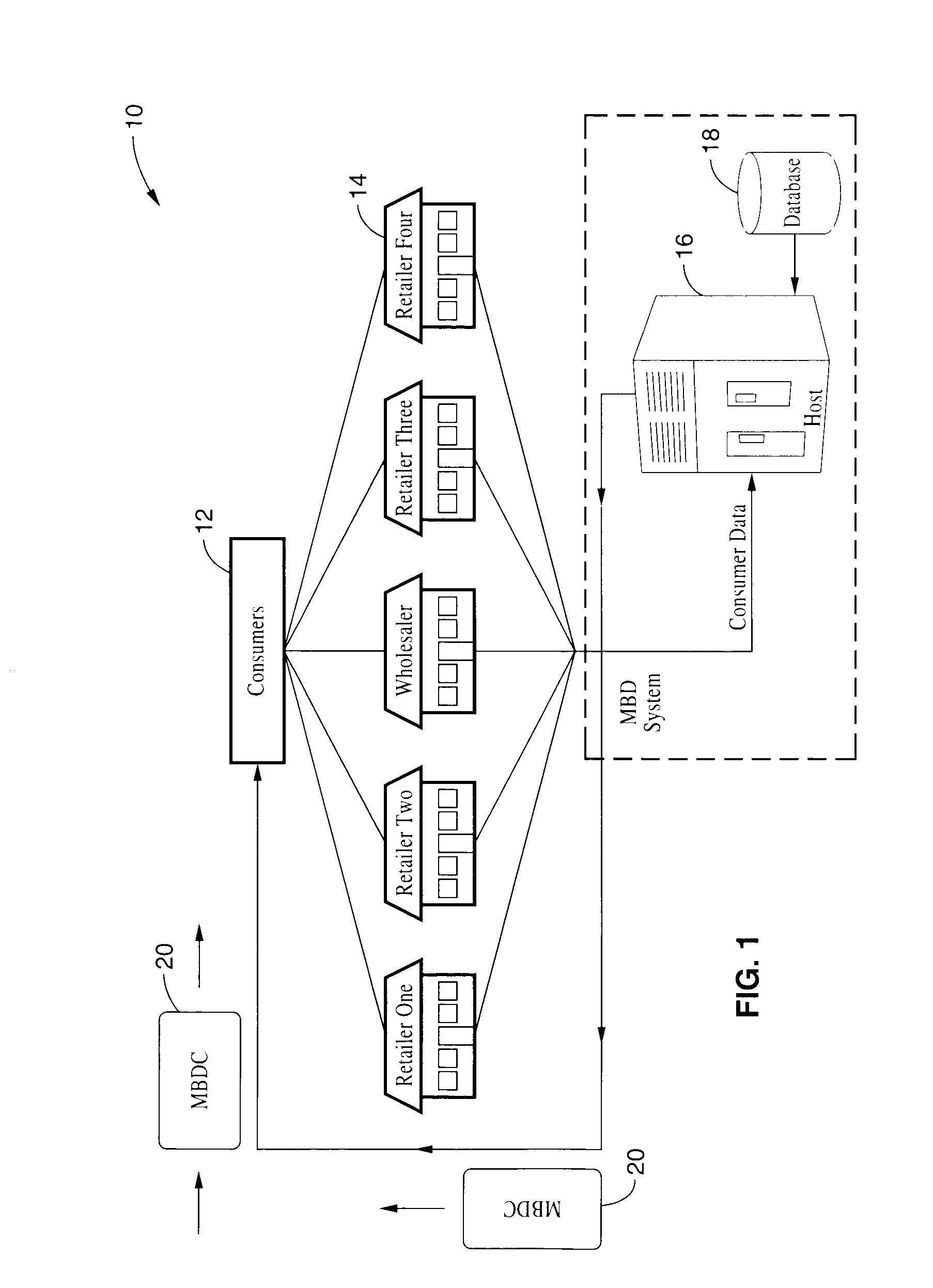

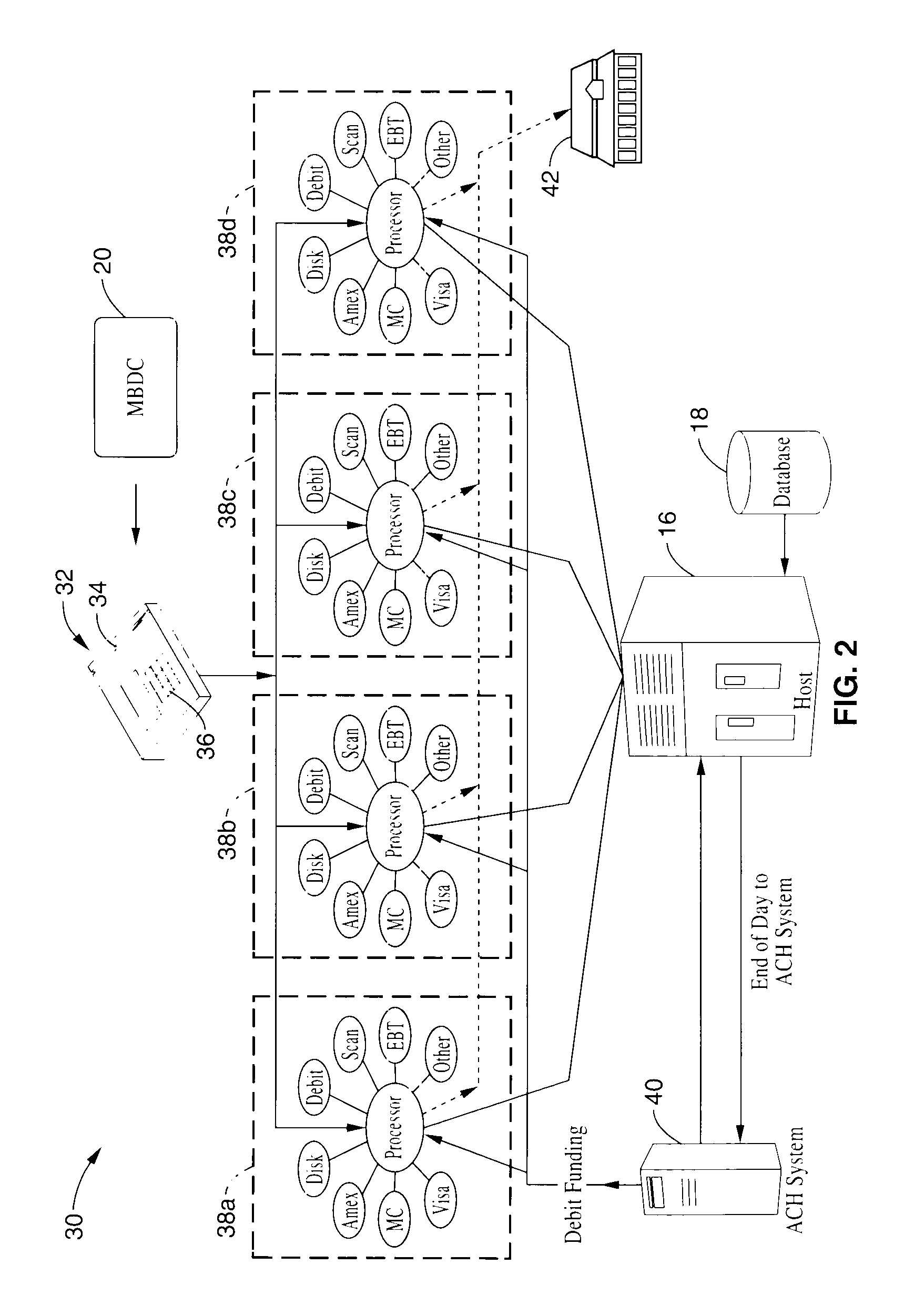

Method and system for facilitating electronic funds transactions

InactiveUS7104443B1Measurement is limitedReduce transaction costsComplete banking machinesFinanceInformation sharingMerchant account

A method and system for executing electronic funds transactions using a merchant based debit (MBD) card in a merchant-centric system that provides for reduced fees to acquiring merchants and remitting a portion of the collected fees to issuing merchants. The system also preferably provides information sharing on consumer transactions with merchants to facilitate consumer based incentive programs and the like. The system operates over conventional card processing infrastructure and utilizes the ACH network, or equivalent, to settle the transaction from a consumer checking account, or a merchant account in the case of a prepaid MBD card. Using the system, merchants may elect to qualify customers based on their own criterion. A portion of the interchange fee is distributed to the issuing merchant associated transaction executed using the merchant based debit card. Embodiments are described for prepaid, fixed value, programmable, and refillable, forms of merchant based debit cards.

Owner:KIOBA PROCESSING LLC

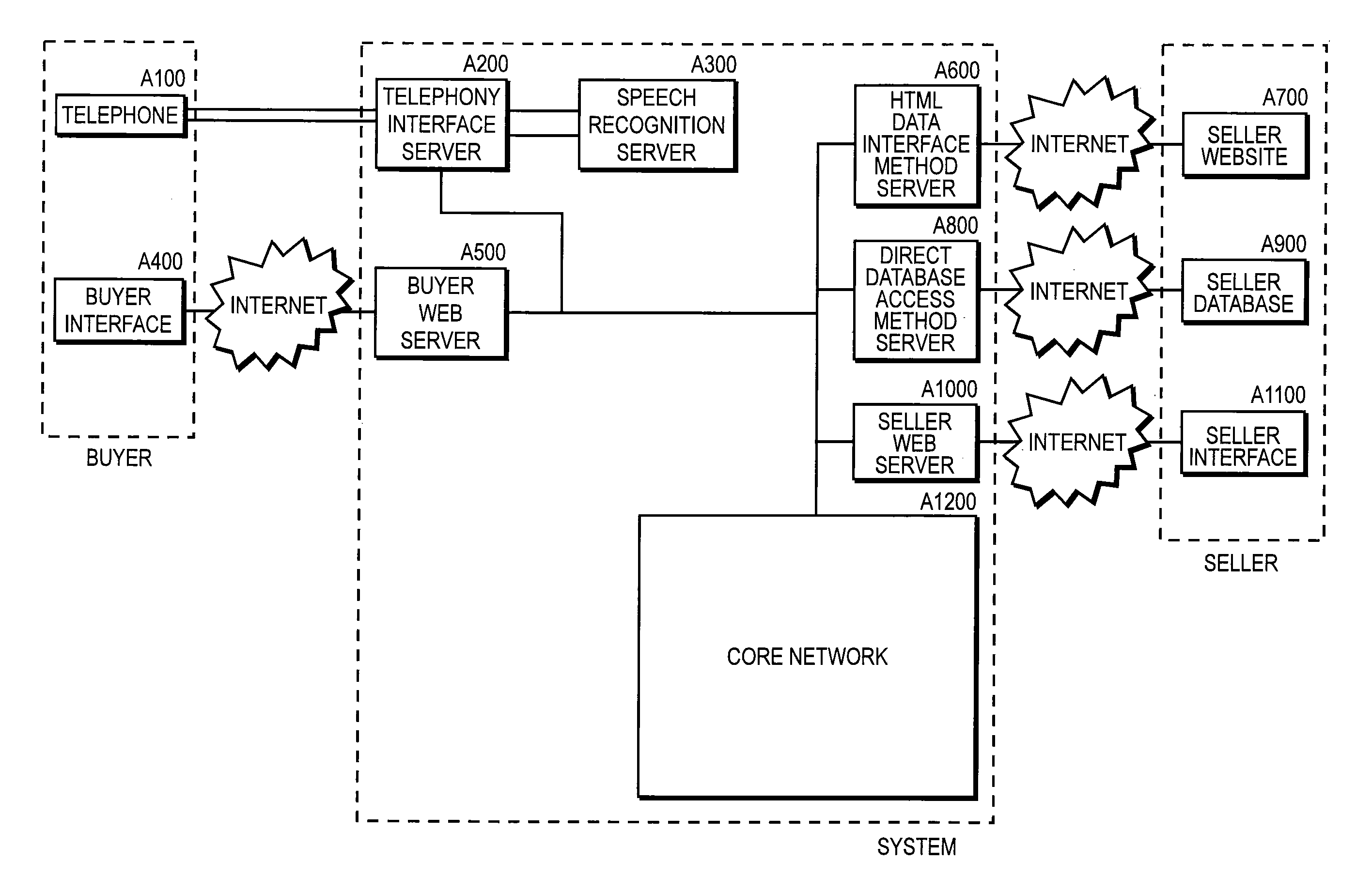

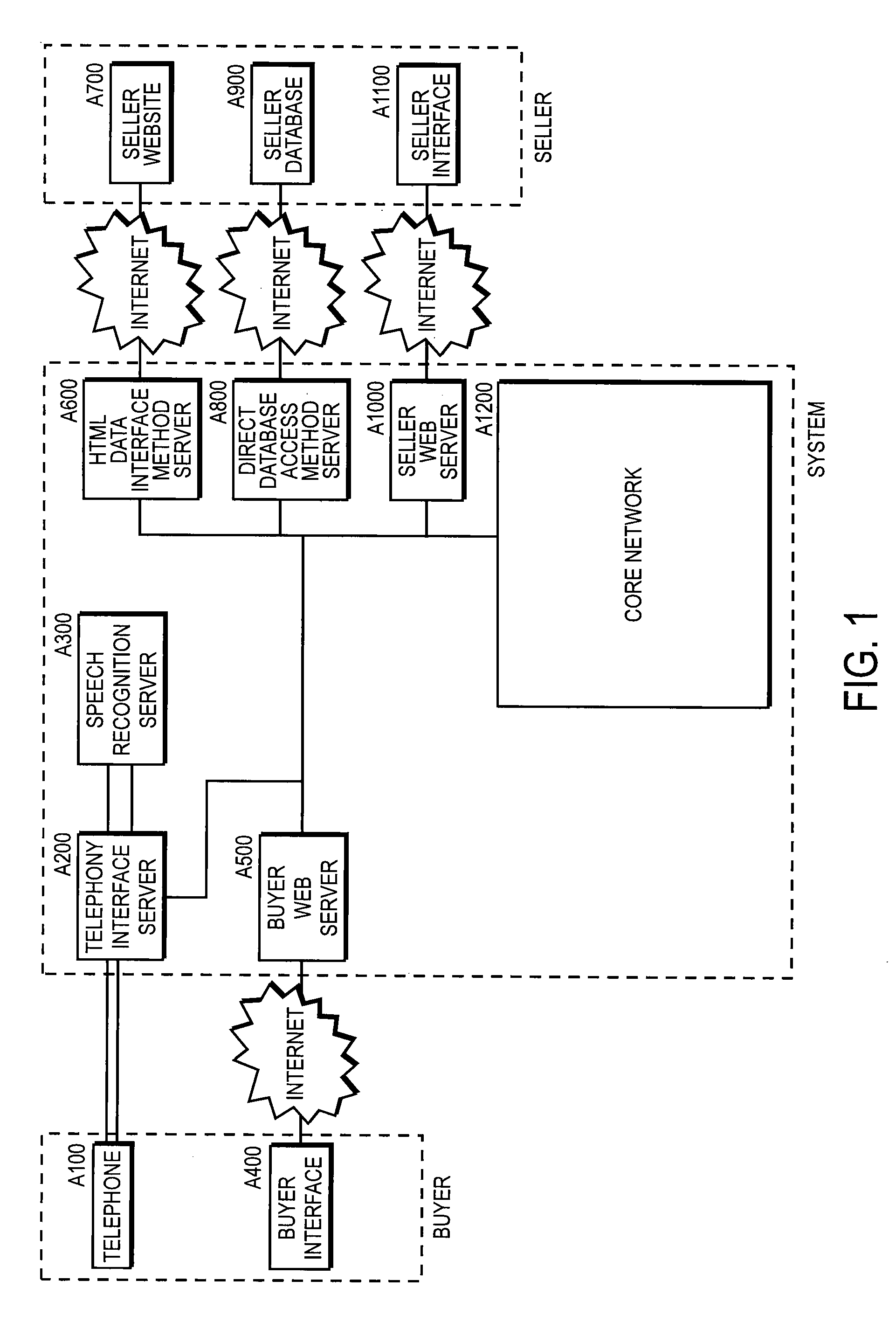

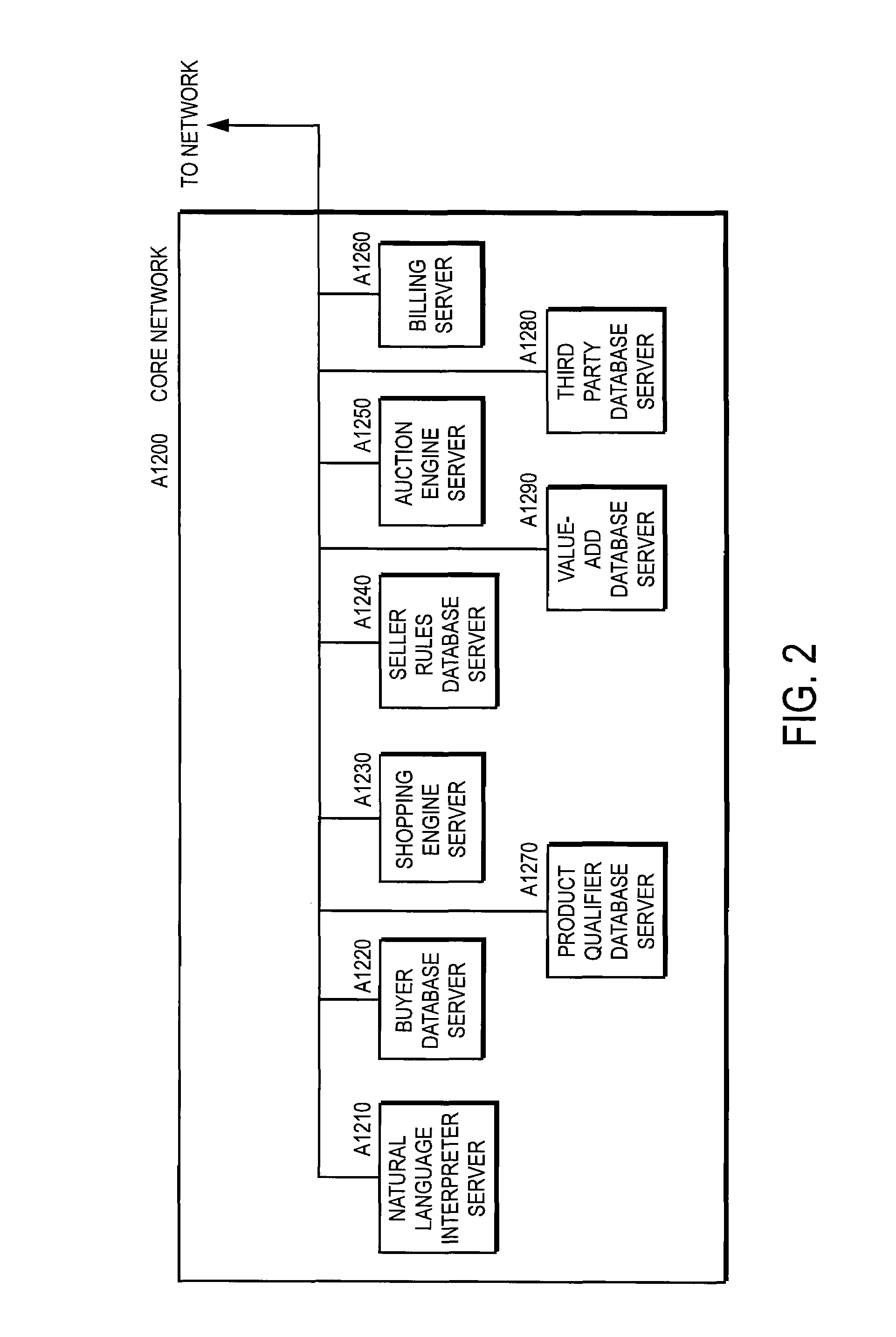

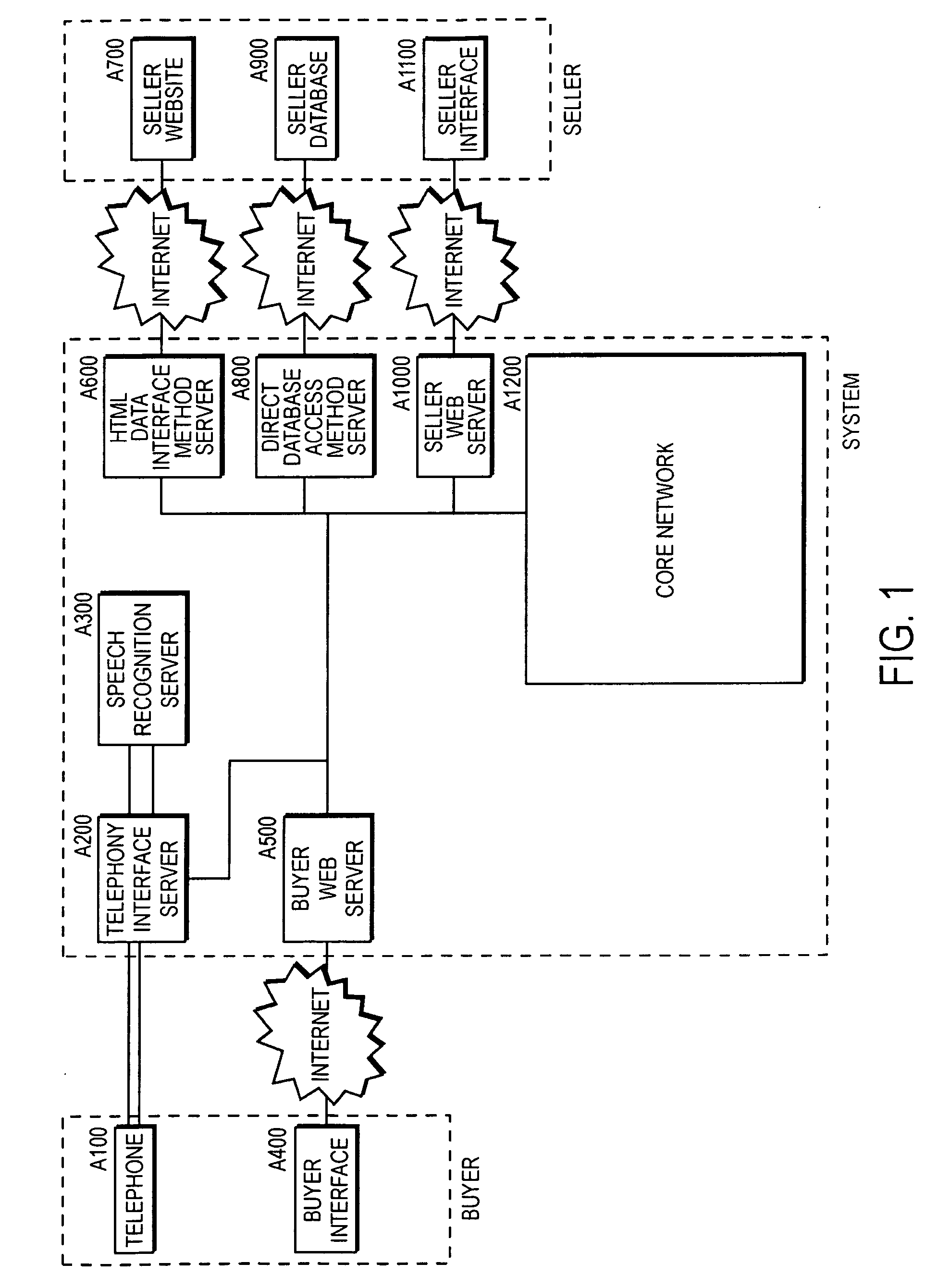

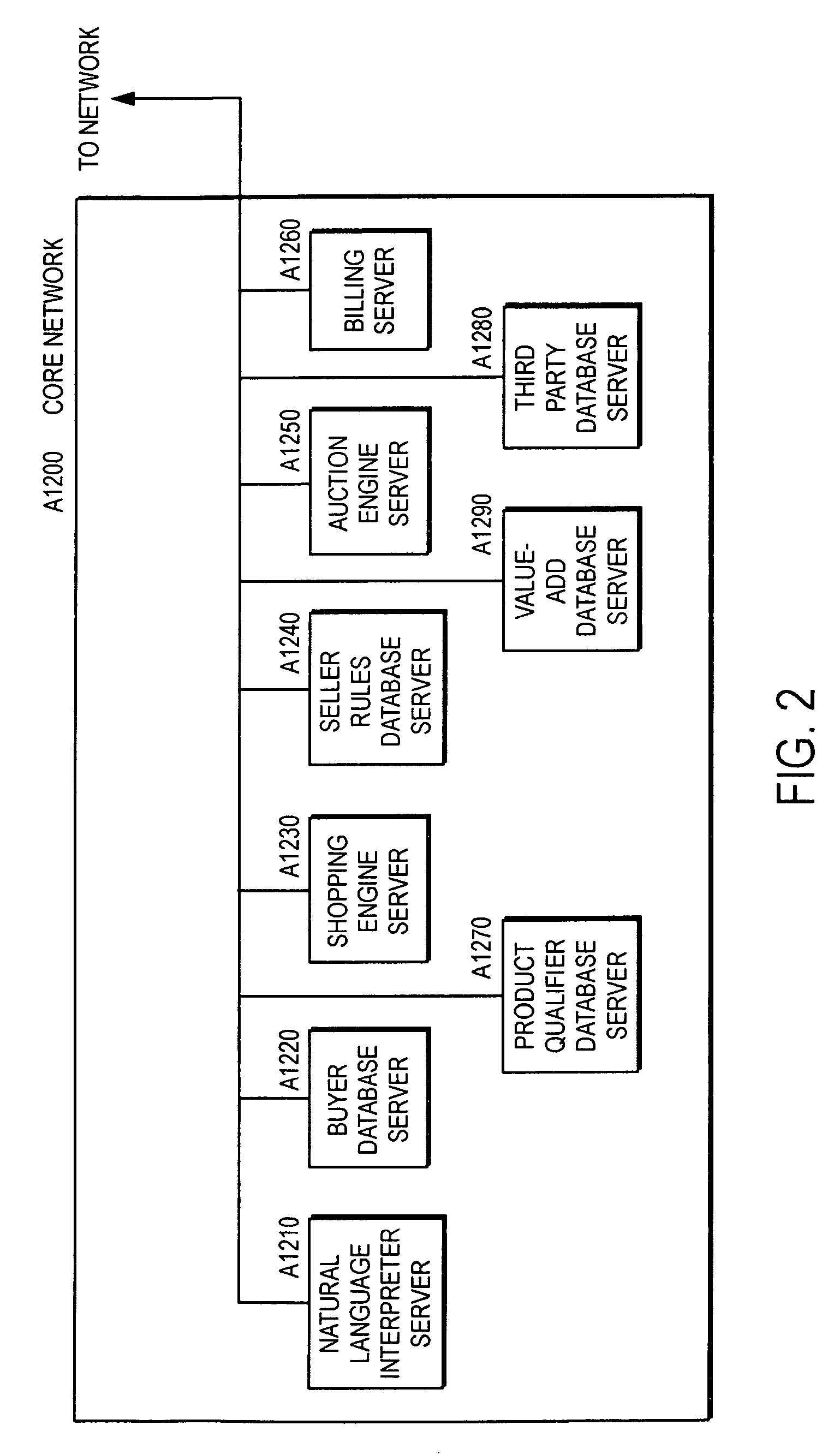

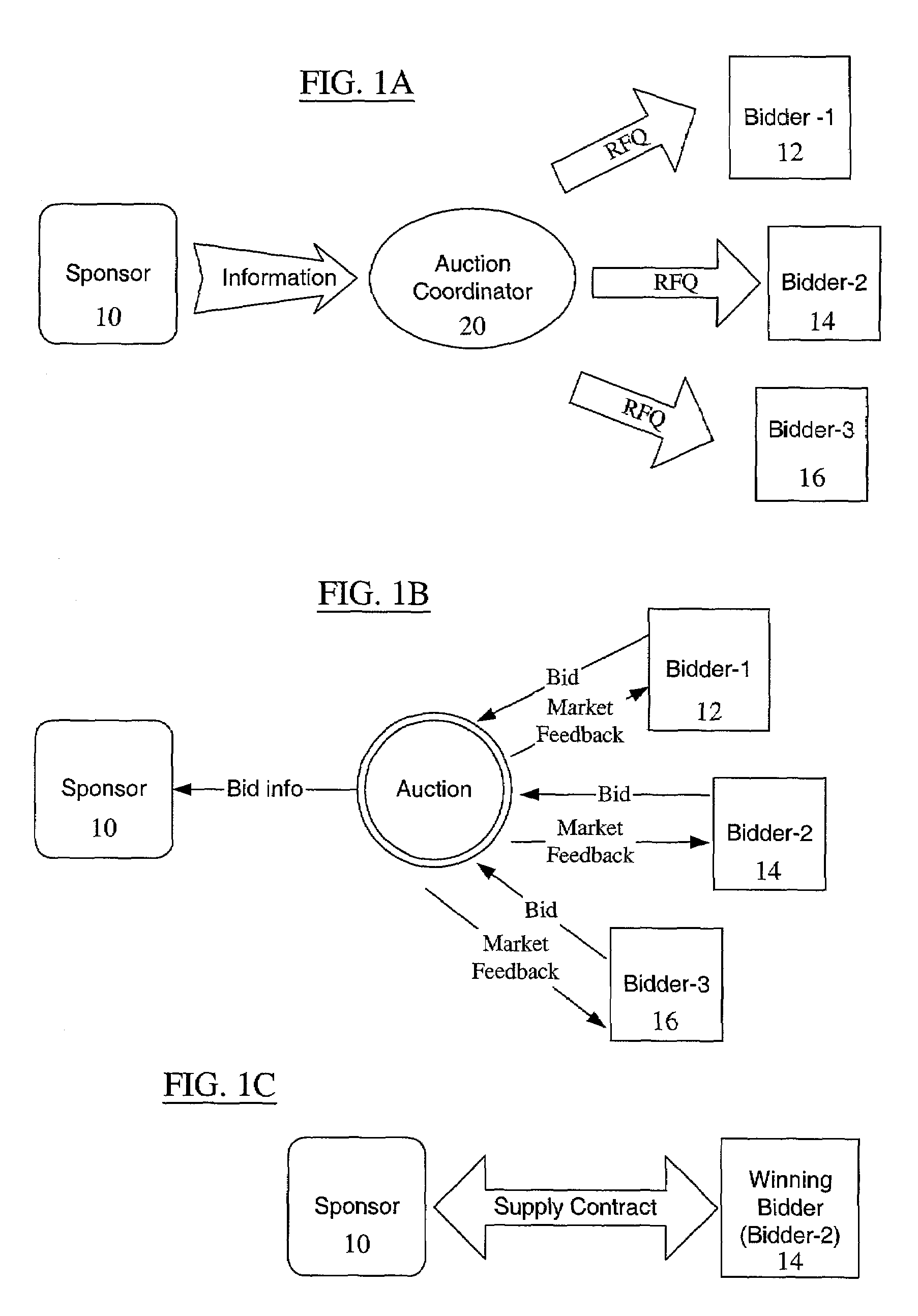

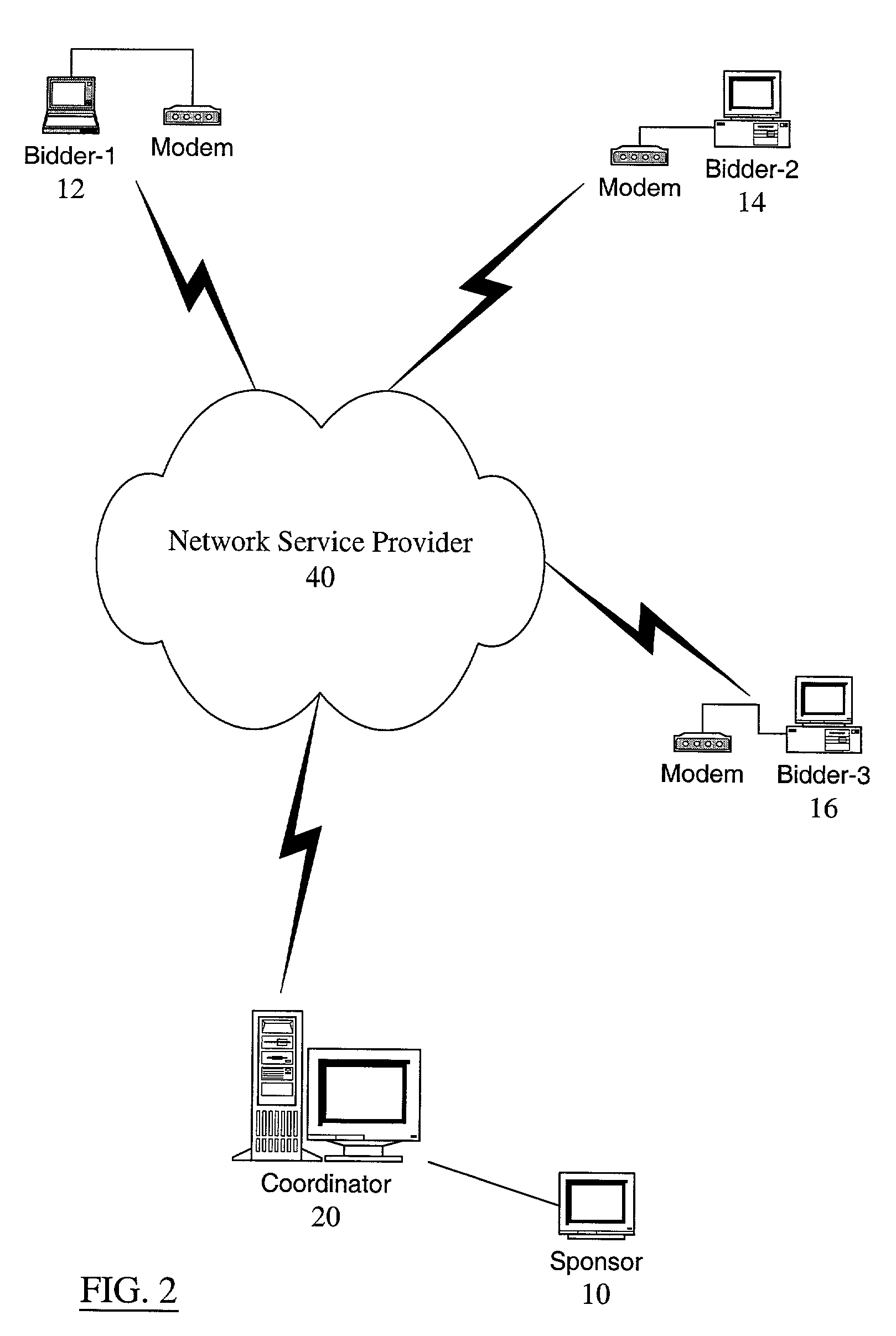

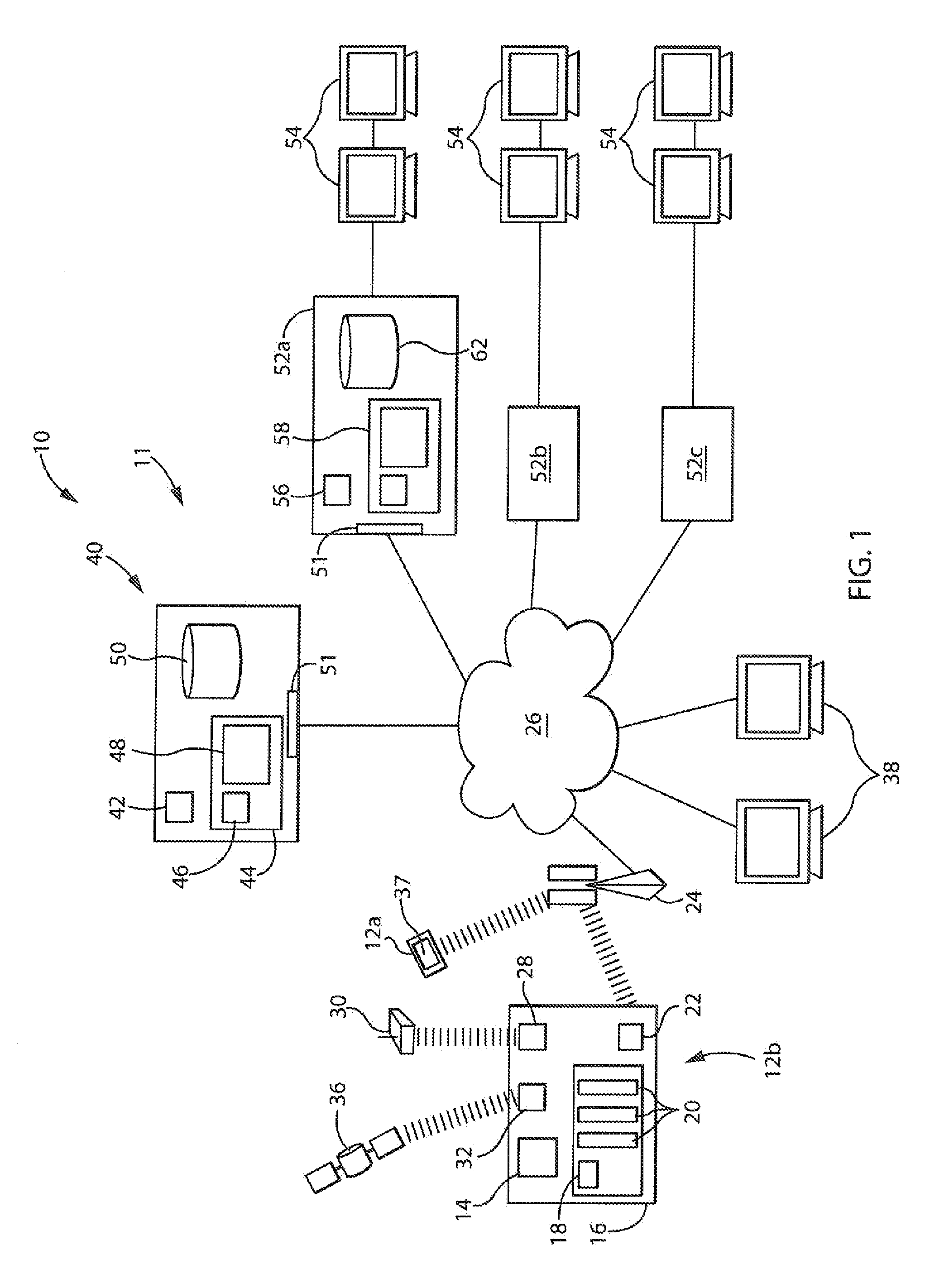

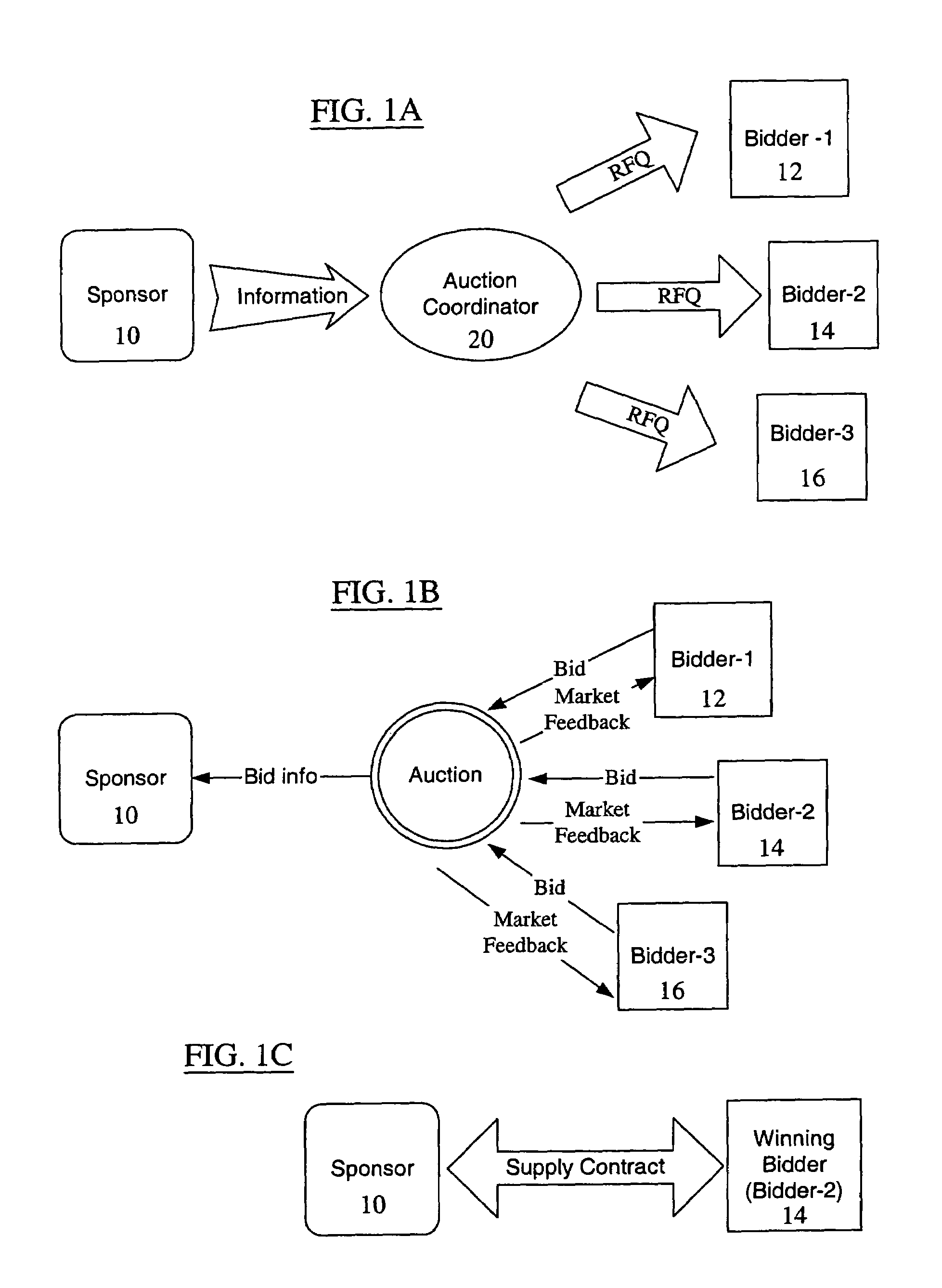

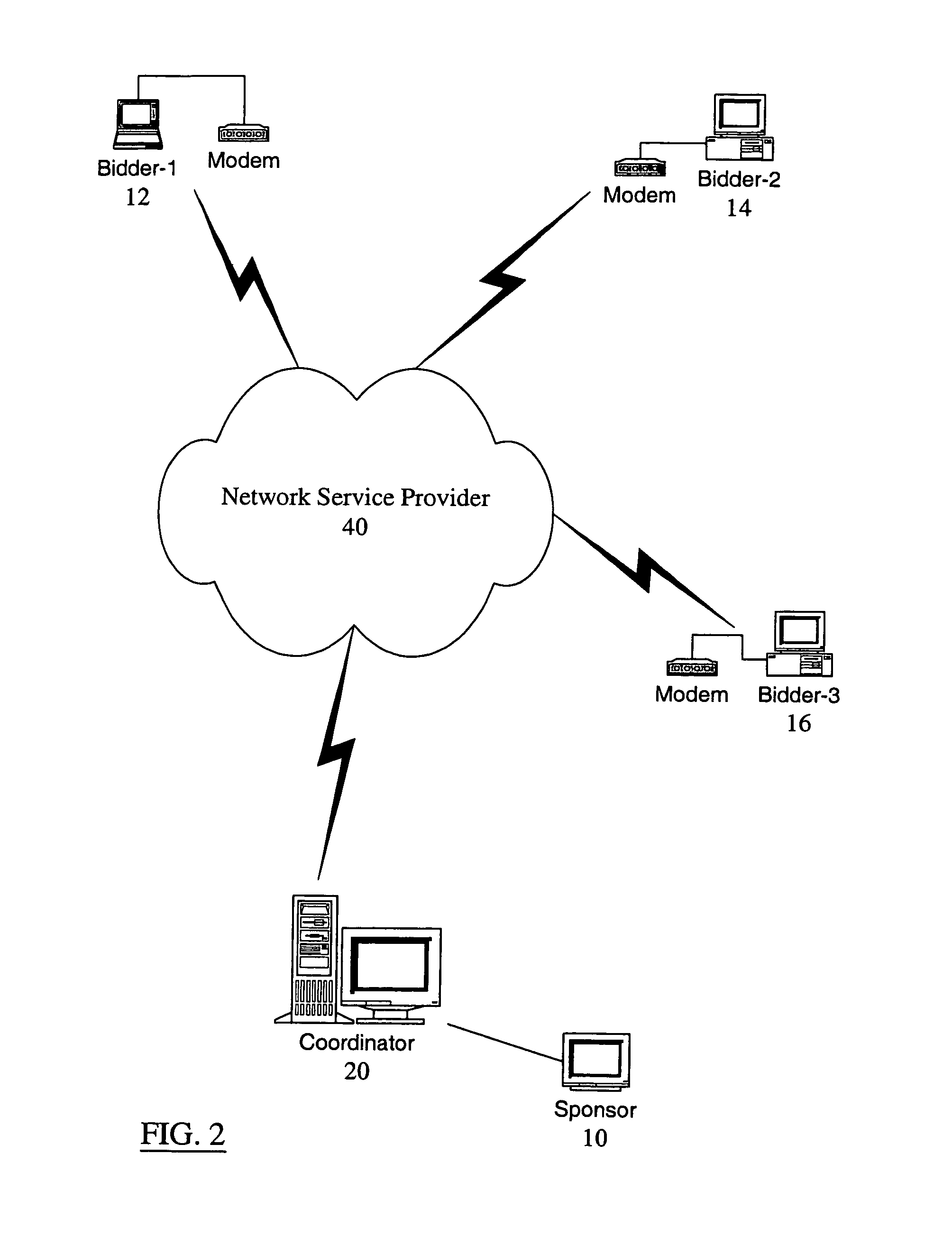

Method, system and business model for a buyer's auction with near perfect information using the internet

InactiveUS7330826B1Reduce transaction costsProvide feedbackInput/output for user-computer interactionFinanceThe InternetKnowledge management

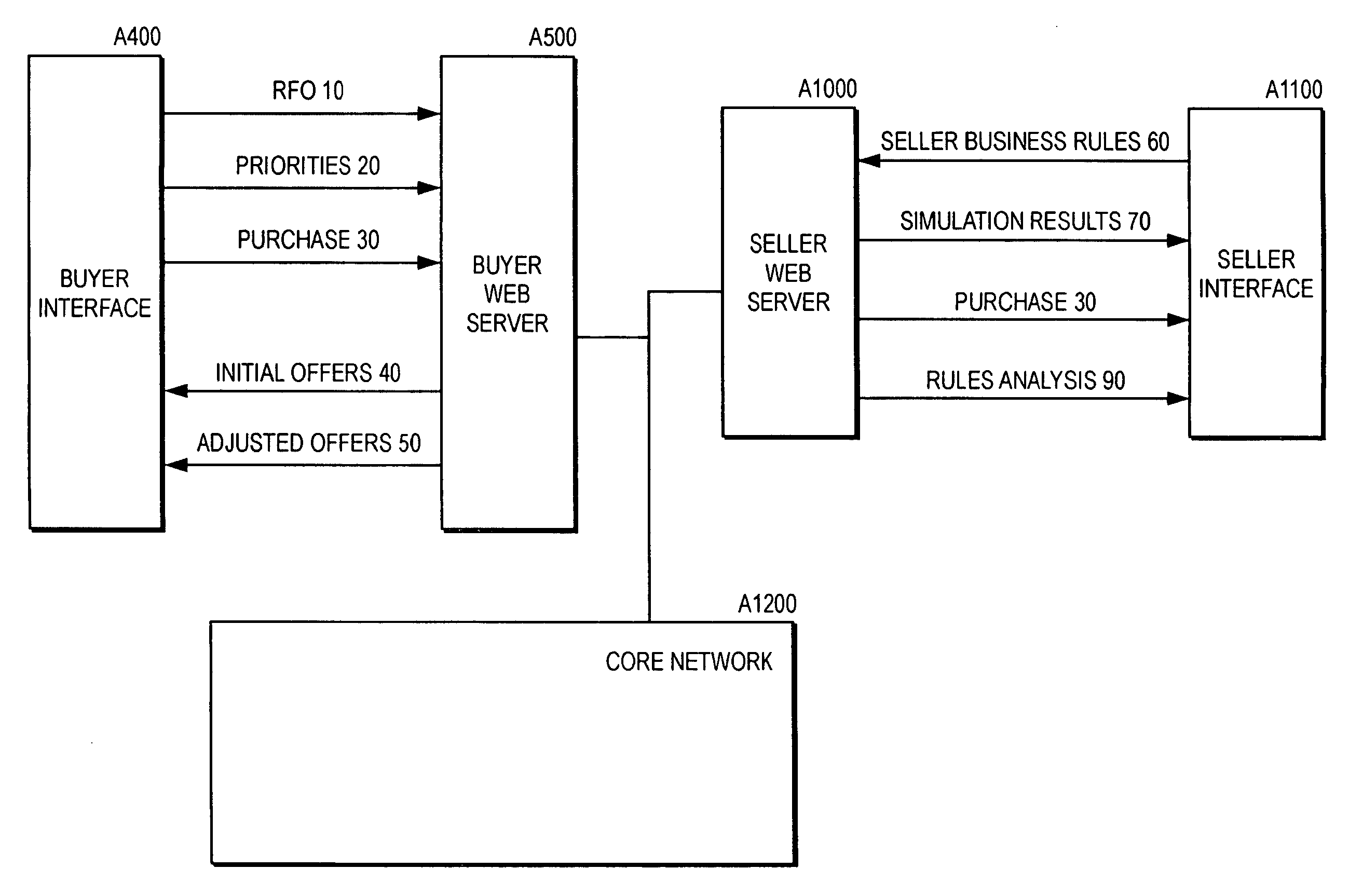

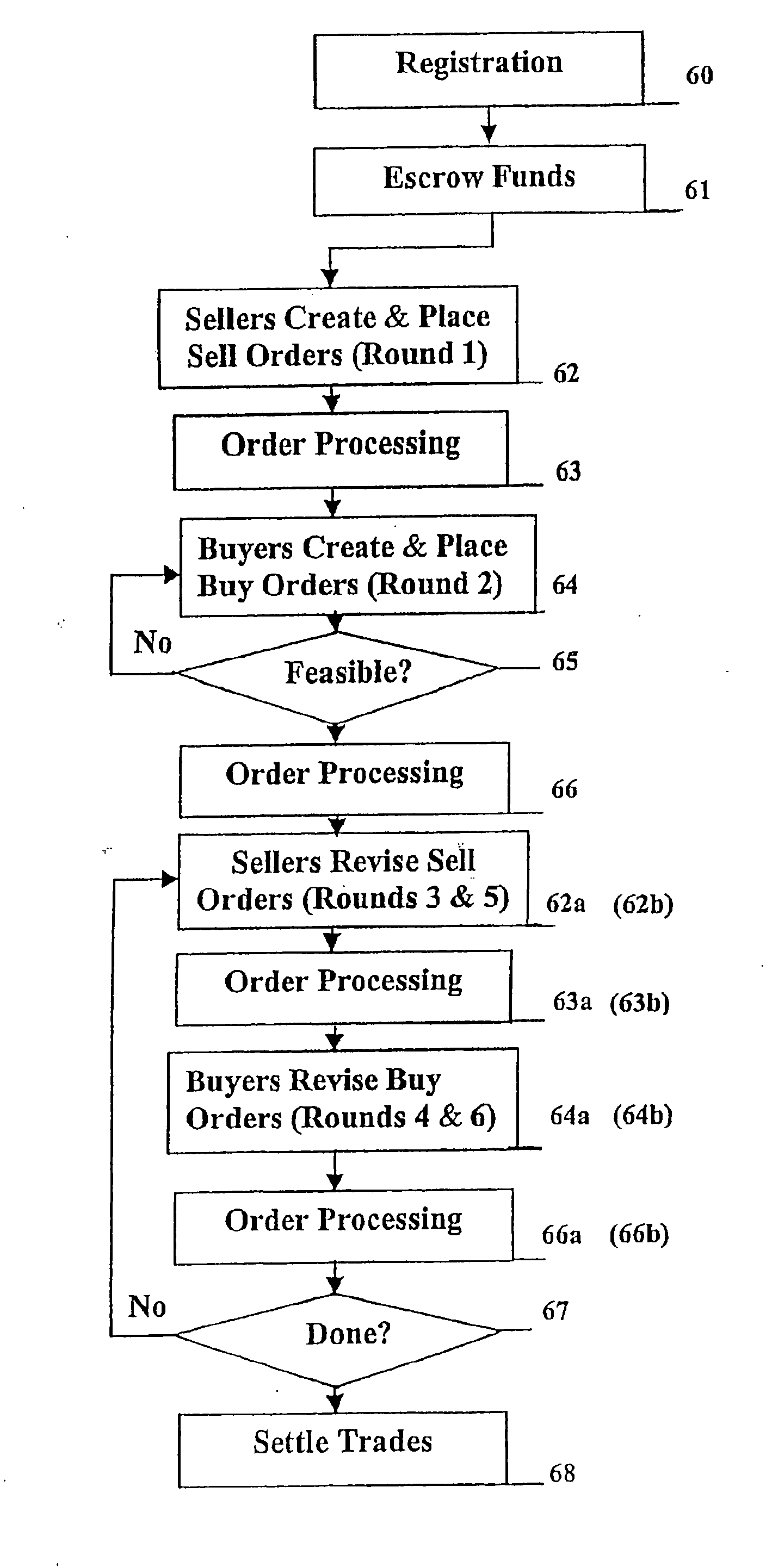

A methodology, system and business model are disclosed for facilitating a fully automated buyer's auction in which the major types of transaction costs are significantly reduced by providing the buyer and the sellers with near-perfect information about one another, including information about buyer preferences and competing sellers' offers. The system implements a buyer's auction with multidimensional bidding that minimizes market intelligence, search, bargaining and transaction execution costs and thus creates more competitive, frictionless markets. Buyers and sellers can efficiently conduct the buyer's auction within a unified environment, thereby minimizing buyer integration costs as well. The buyer's auction generates commercially marketable proprietary information and a revenue stream for the auctioneer providing such a service.

Owner:PERFECT COMMERCE

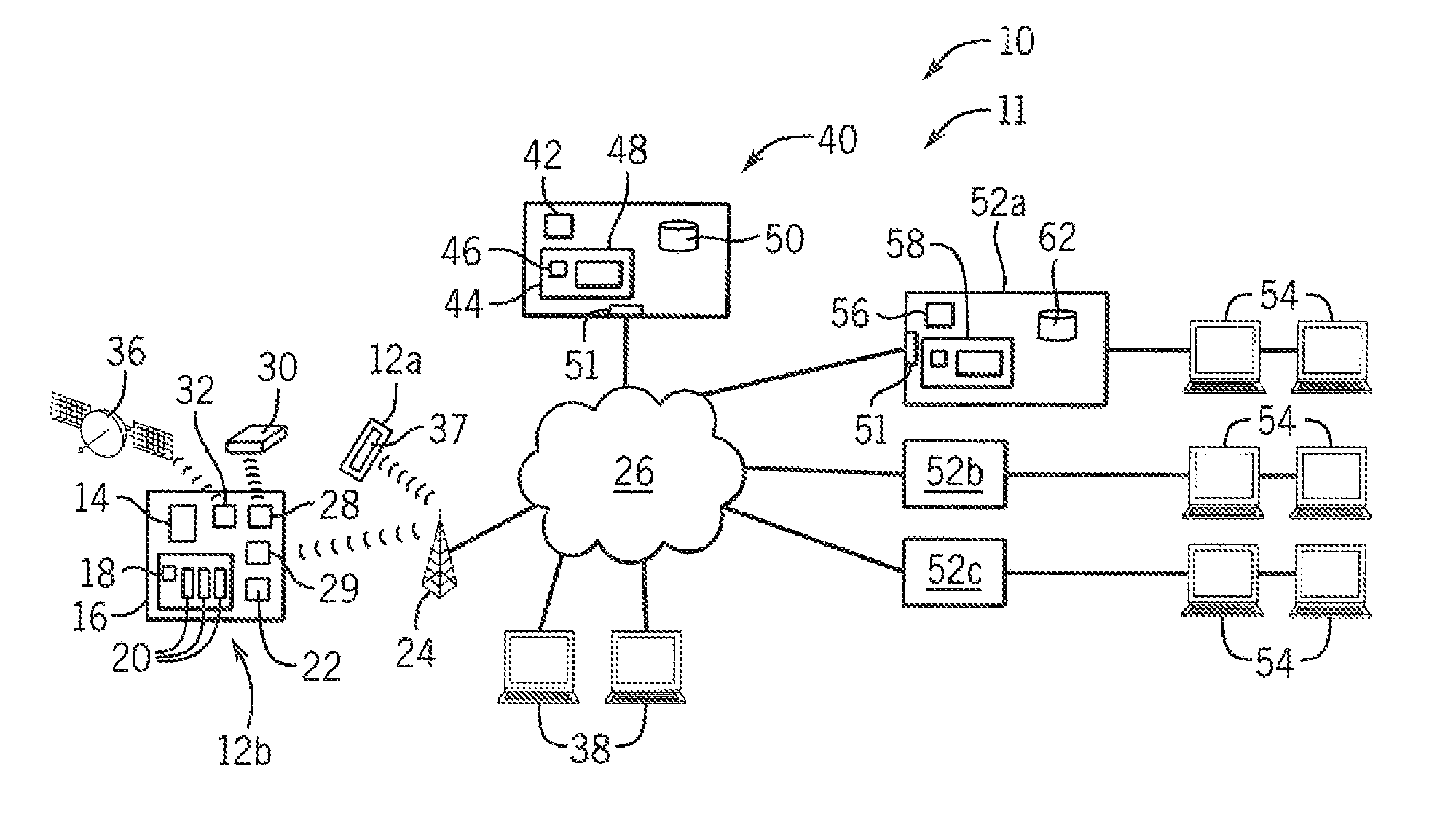

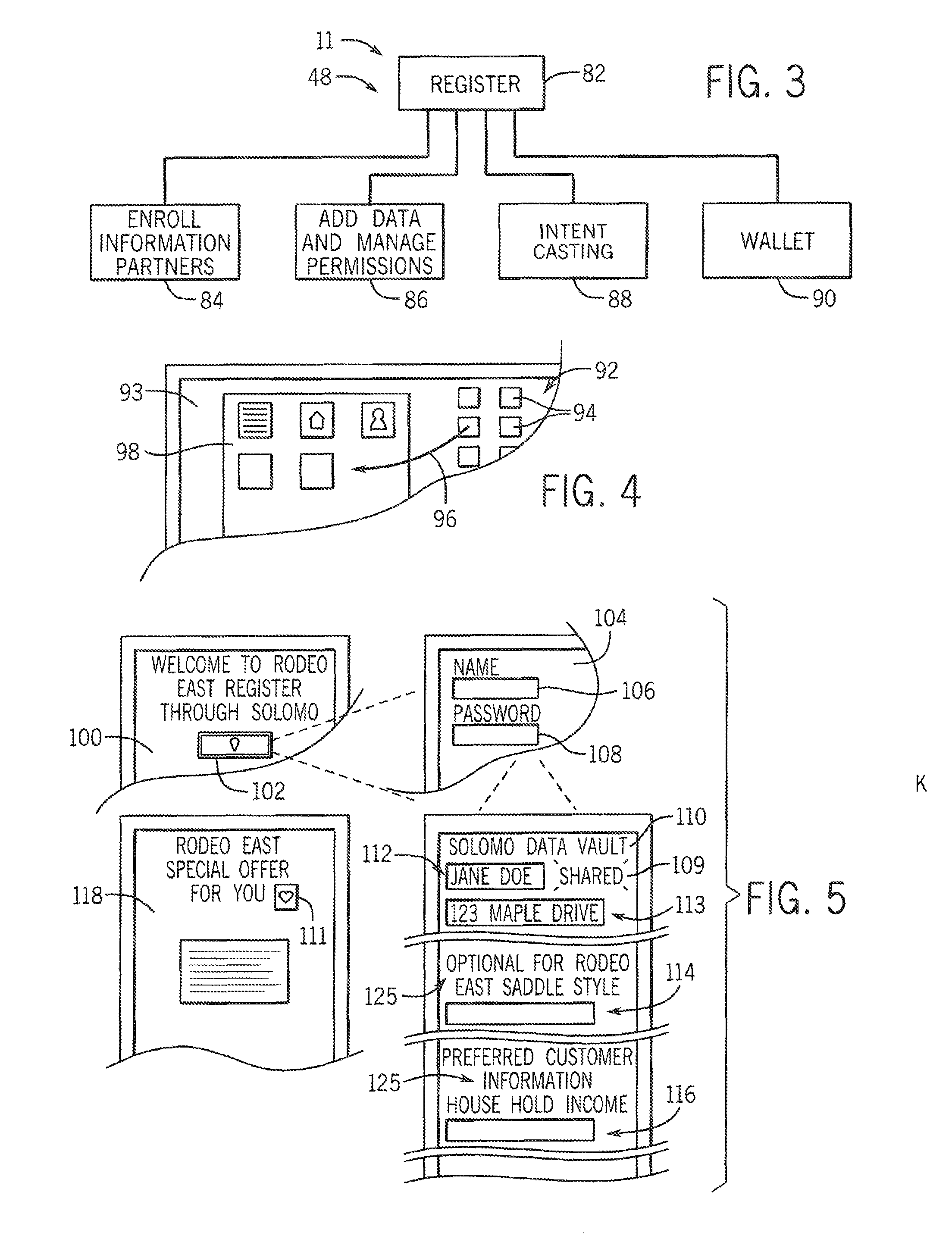

Personal data management system with global data store

InactiveUS9092796B2Reduce transaction costsRedundant data entryDigital data protectionDigital data authenticationData managementData storing

A data vault system allows for centralized storage of personal data about a consumer in a transparent multi-tiered structure including a global data store and multiple vendor or category cards. Data in the category cards describing a subset of the globally stored data to be shared with individual vendors and provide fine resolution sharing control. The data in each structure is synchronized so that vendor or category cards may be auto populated.

Owner:SOLOMO IDENTITY

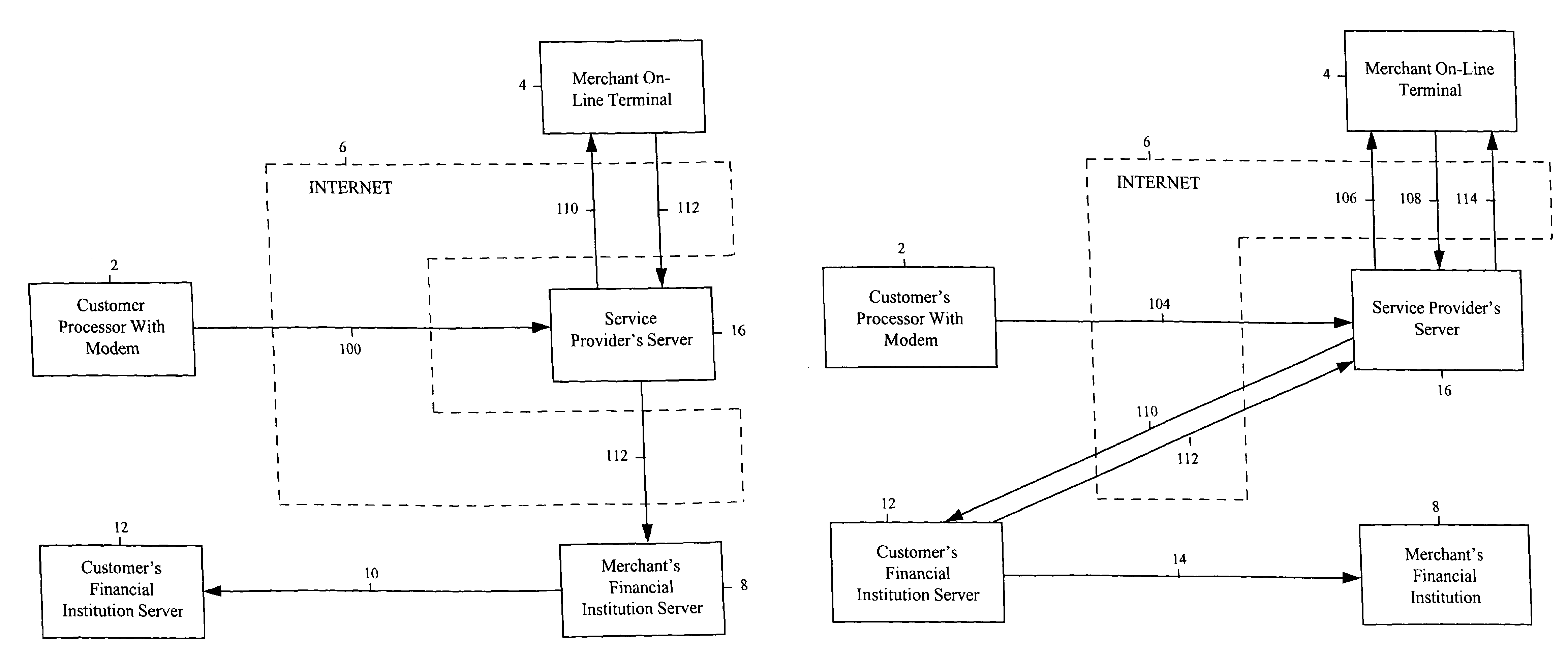

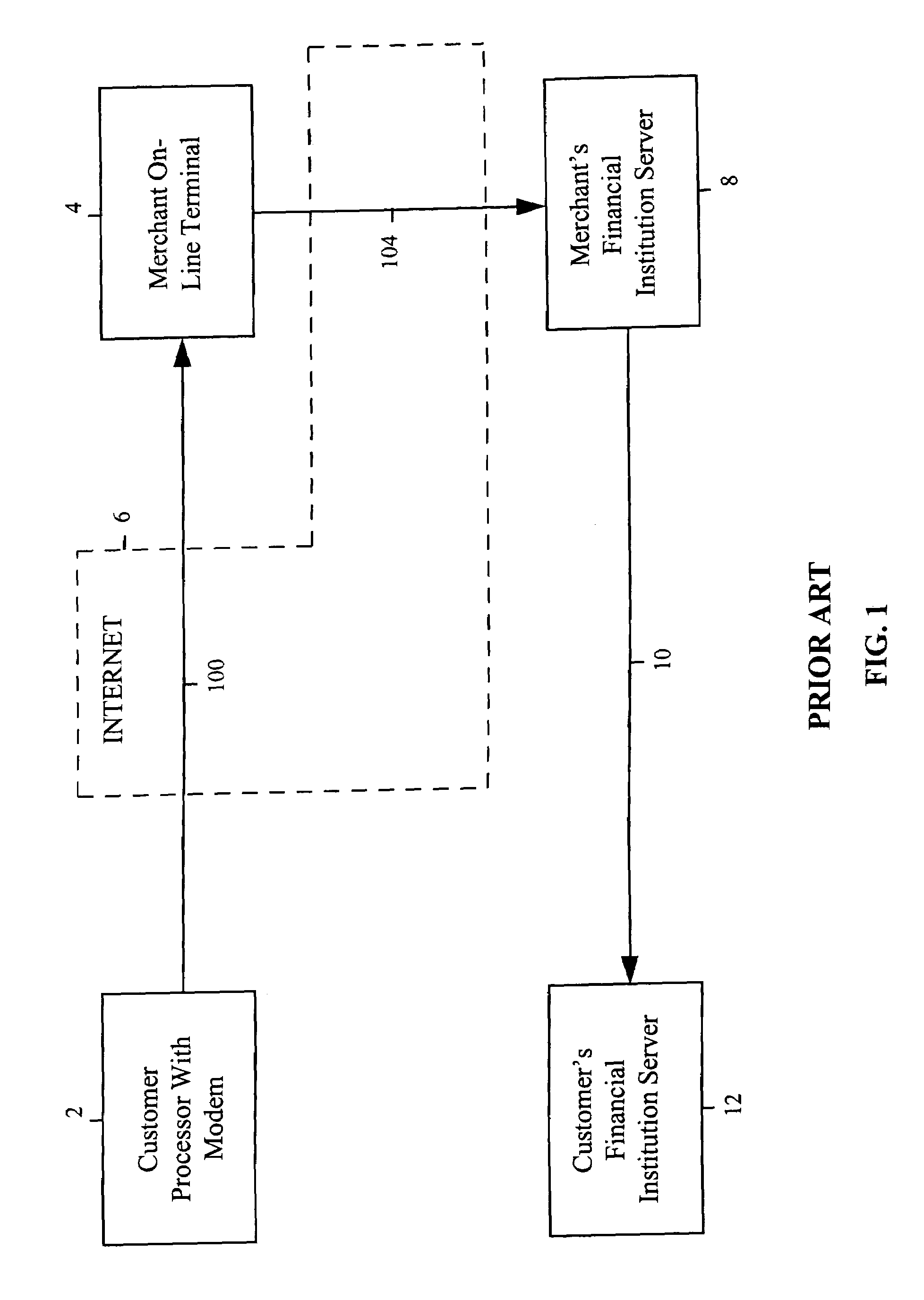

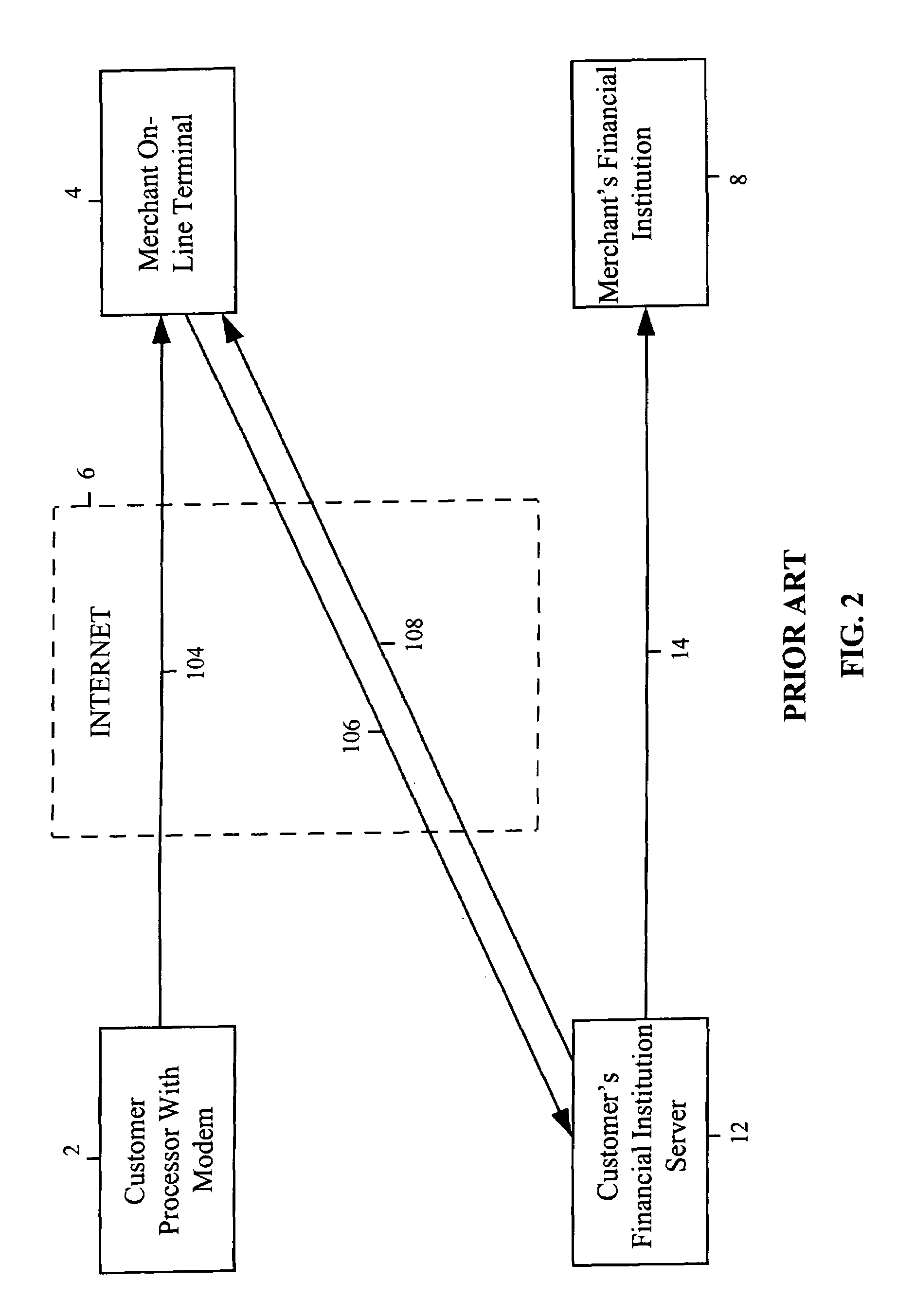

System and method for merchant function assumption of internet checking and savings account transactions

InactiveUS7051001B1Reduce transaction costsSave transaction costFinanceBilling/invoicingPaymentService provision

A system and method for merchant function assumption of Internet checking and savings account transactions enables a service provider to take over all merchant type transactions and provide a merchant, such as an Internet merchant, with an approved order and appropriate credit for the transaction. A service provider server receives an electronic check or a payment instruction for the merchant from a customer. The payment instruction includes, for example, the originator's digital certificate and payment and purchase information, including the originator's checking or savings account number. The payment instruction is automatically sent to a customer's bank's server, which confirms the availability of funds for the payment. A confirmation of the availability of funds is automatically sent to the merchant, and a credit for the payment is automatically sent to the merchant's account. In addition, the service provider can consolidate order and settlement transactions, which saves transaction costs for the merchant.

Owner:CITIBANK

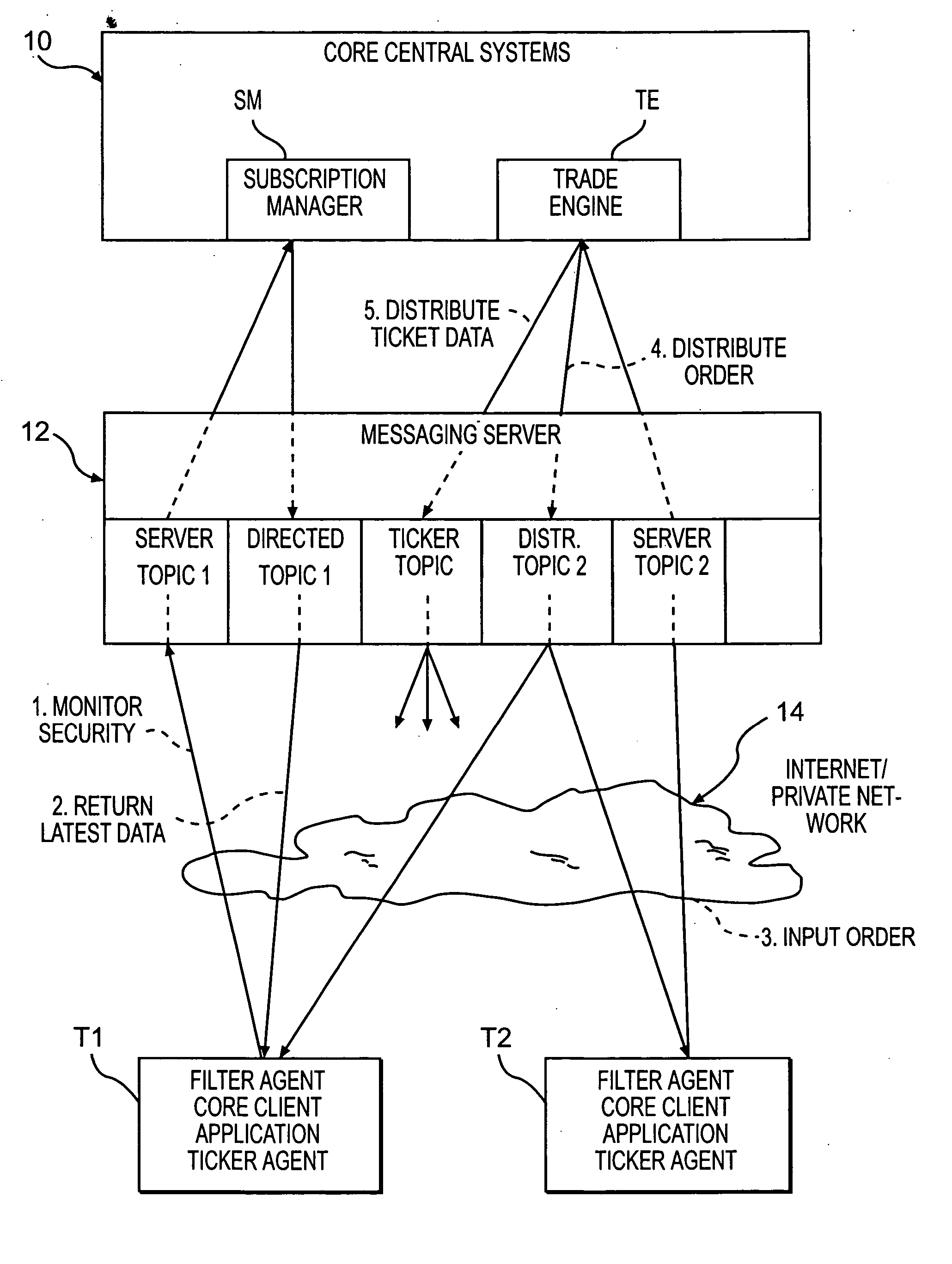

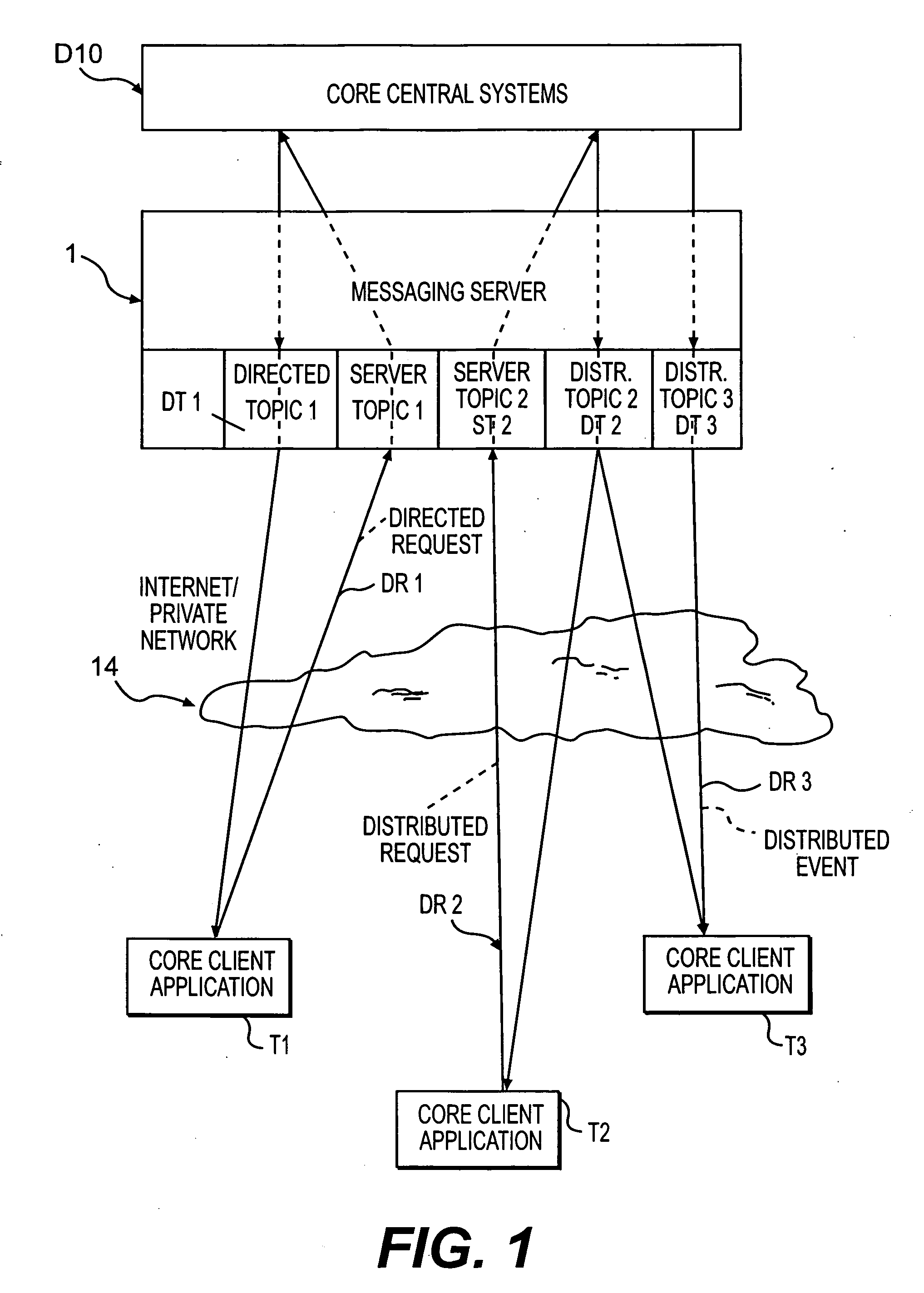

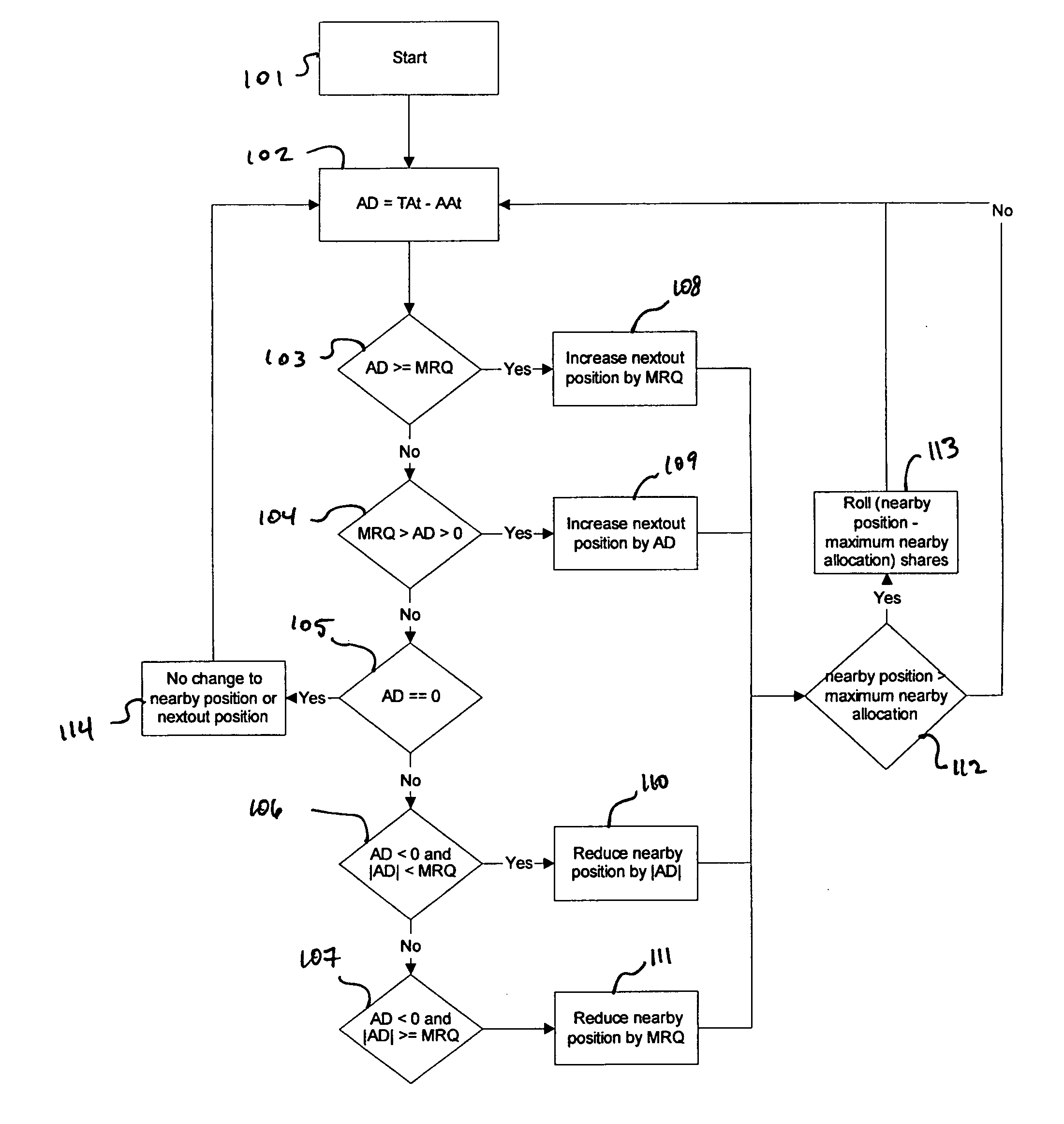

Automated system for conditional order transactions in securities or other items in commerce

InactiveUS7024387B1Facilitates contingentFacilitates conditional tradingFinanceThird partyCommunications system

An apparatus and method of automatically and anonymously buying and selling positions in fungible properties between subscribers. The specific embodiment described in the disclosure relates to the buying and selling of securities or contracts where the offer to purchase or sell the property may be conditioned upon factors such as the ability to purchase or sell other property or the actual purchase or sale of other property. Specifically, the system described includes methods by which the system will sort and display the information available on each order, methods by which the system will match buy and sell order and attempt to use other markets to effect the execution of transactions without violating conditions set by the subscriber, methods by which the apparatus will execute transaction and report prices to third parties such that the user is satisfied and short sales are reported as prescribed by the rules and regulations of the appropriate regulatory body governing each subscriber in the associated transaction. A communication system is described which allows subscribers to communicate anonymously for the purpose of effecting transactions in such property under such conditions.

Owner:5TH MARKET

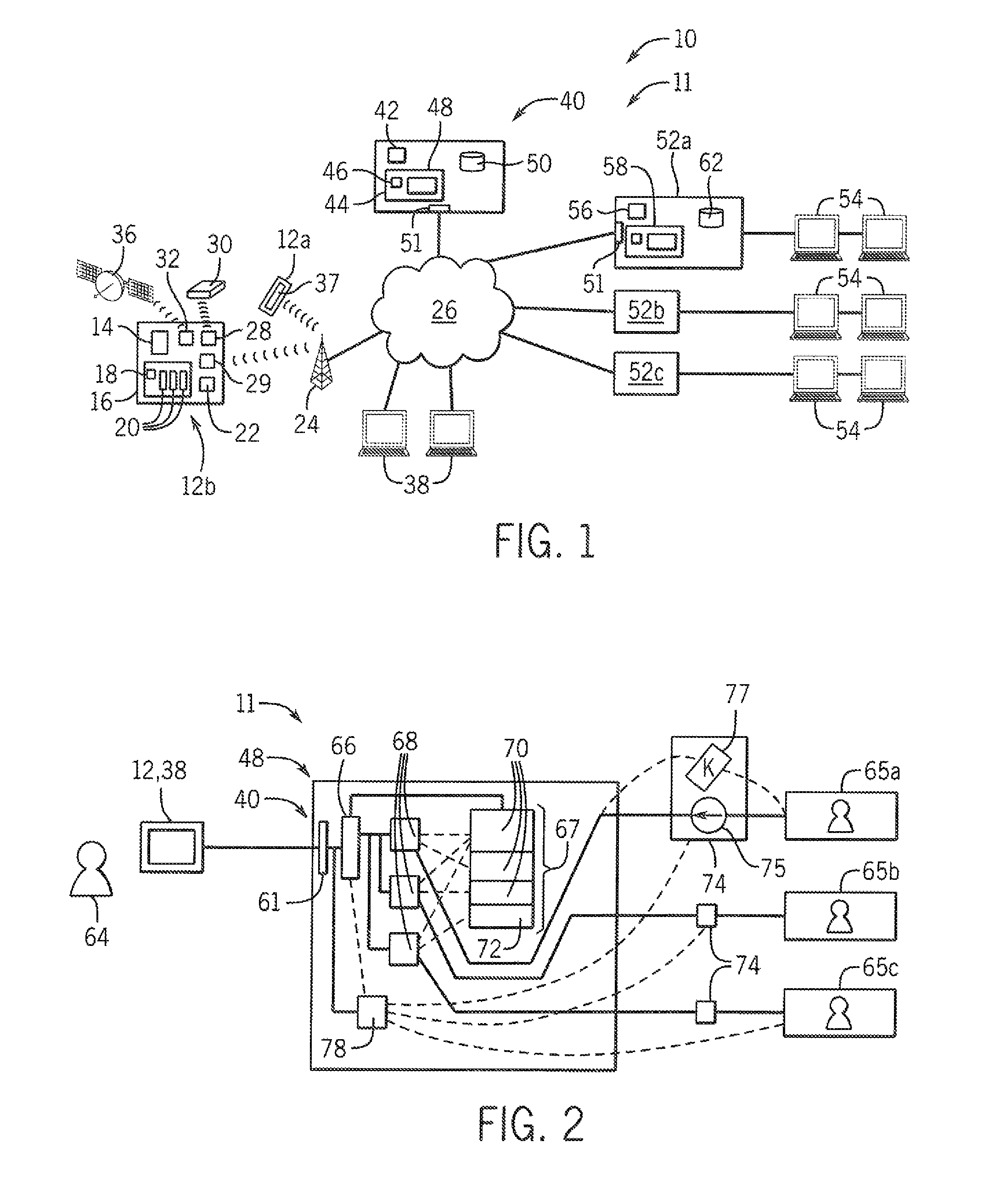

Personal data management system with sharing revocation

InactiveUS8893297B2Reduce transaction costsRedundant data entryDigital data processing detailsAnalogue secracy/subscription systemsInternet privacyData management

A data vault system allows for centralized storage of personal data about a consumer associated with sharing permissions designating how that data may be shared and including an option to revoke permission of previously shared data. Data may be collected into cards describing a subset of globally stored data to be shared with individual vendors and providing separate sharing statuses for fine resolution control. Both intentionally entered personal data and data collected about the consumer may be protected in this data vault system.

Owner:SOLOMO IDENTITY

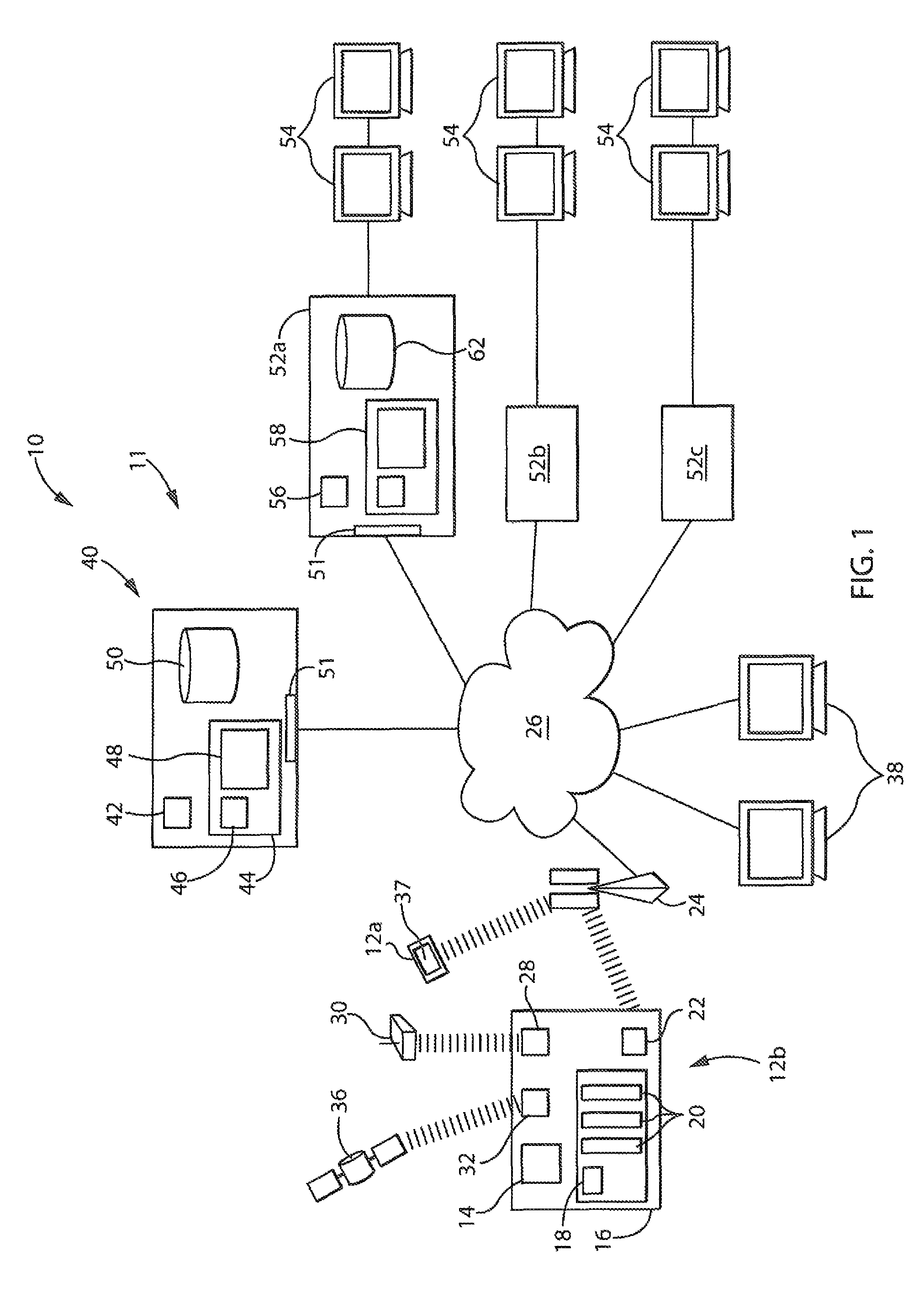

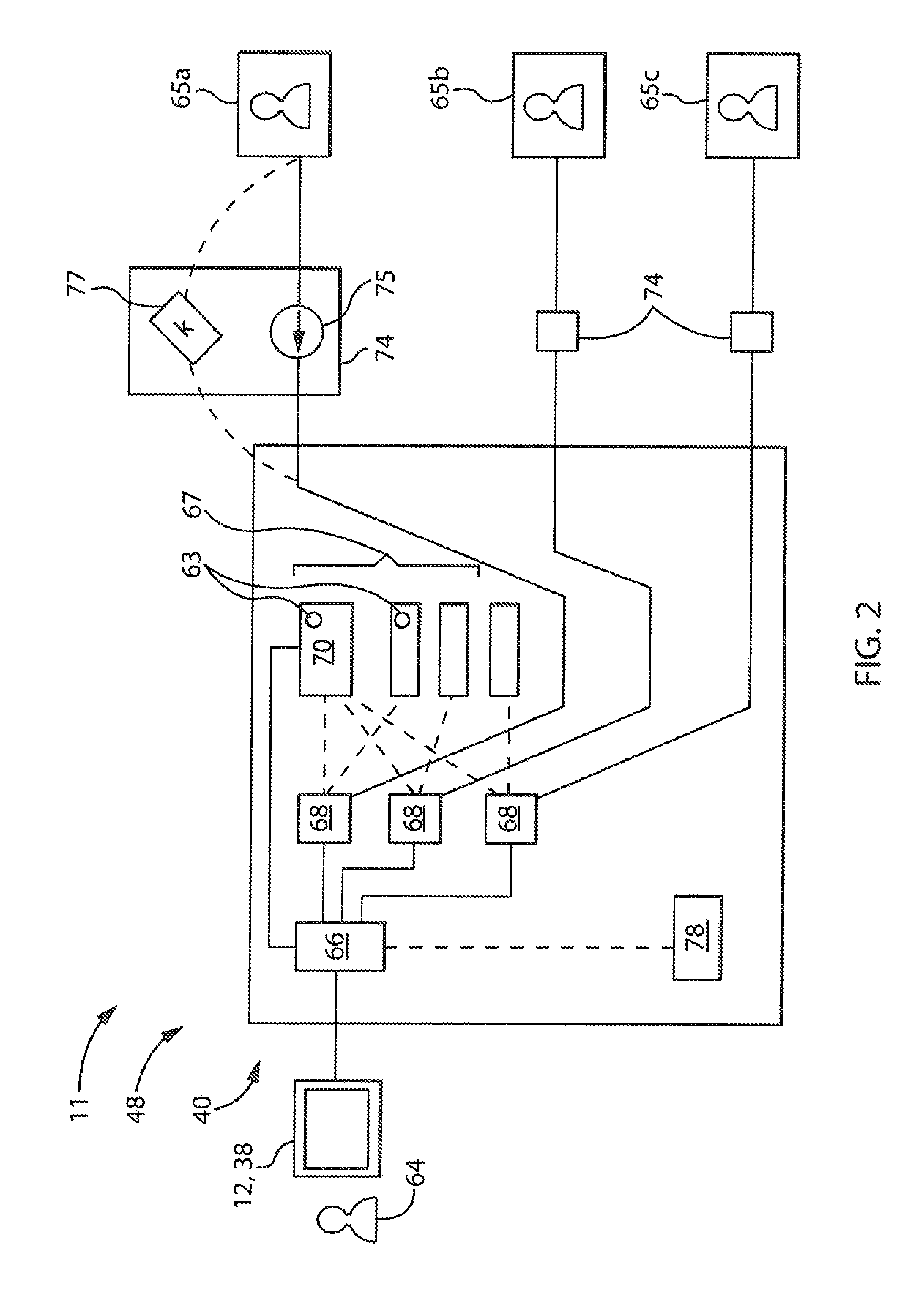

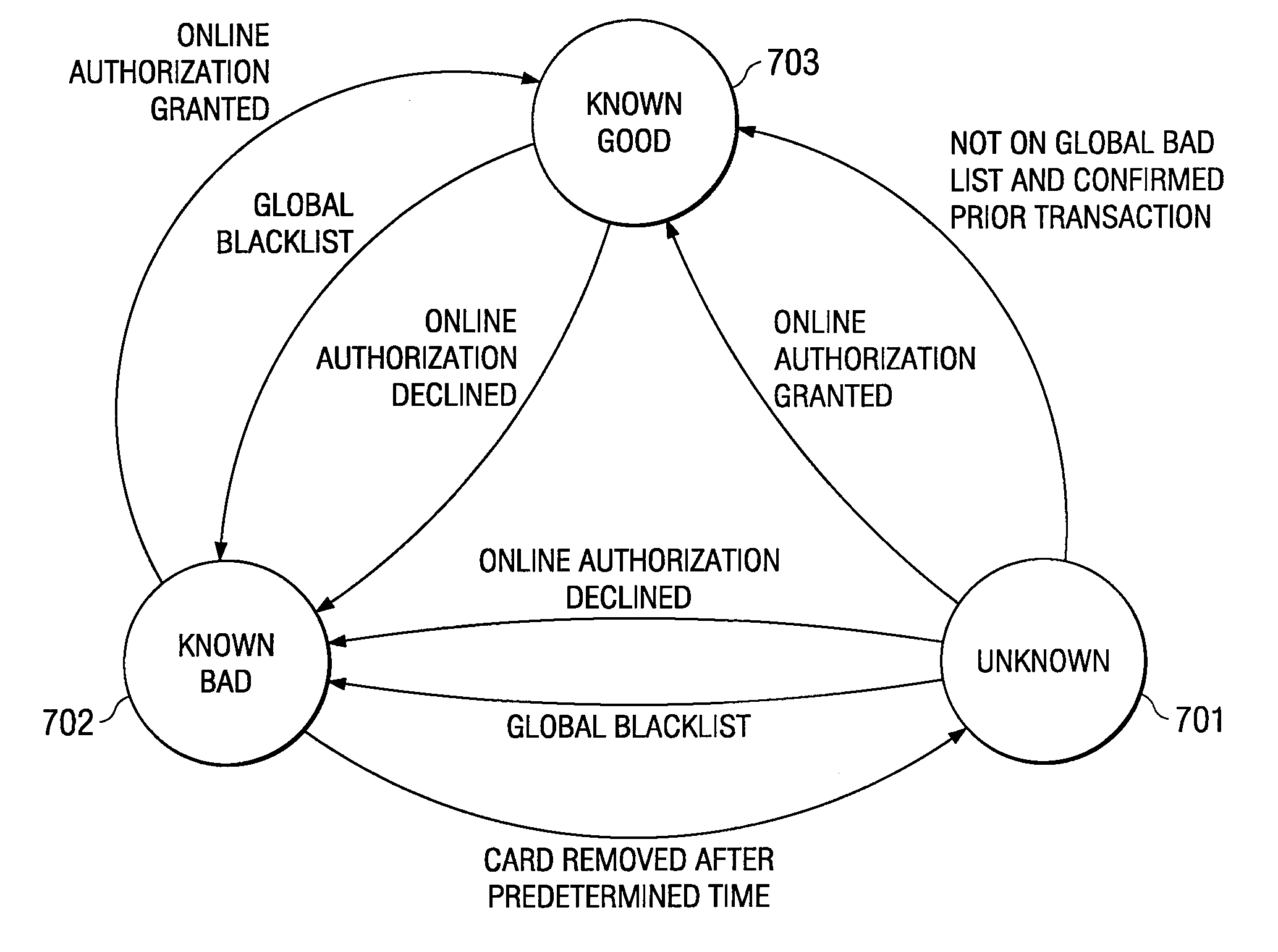

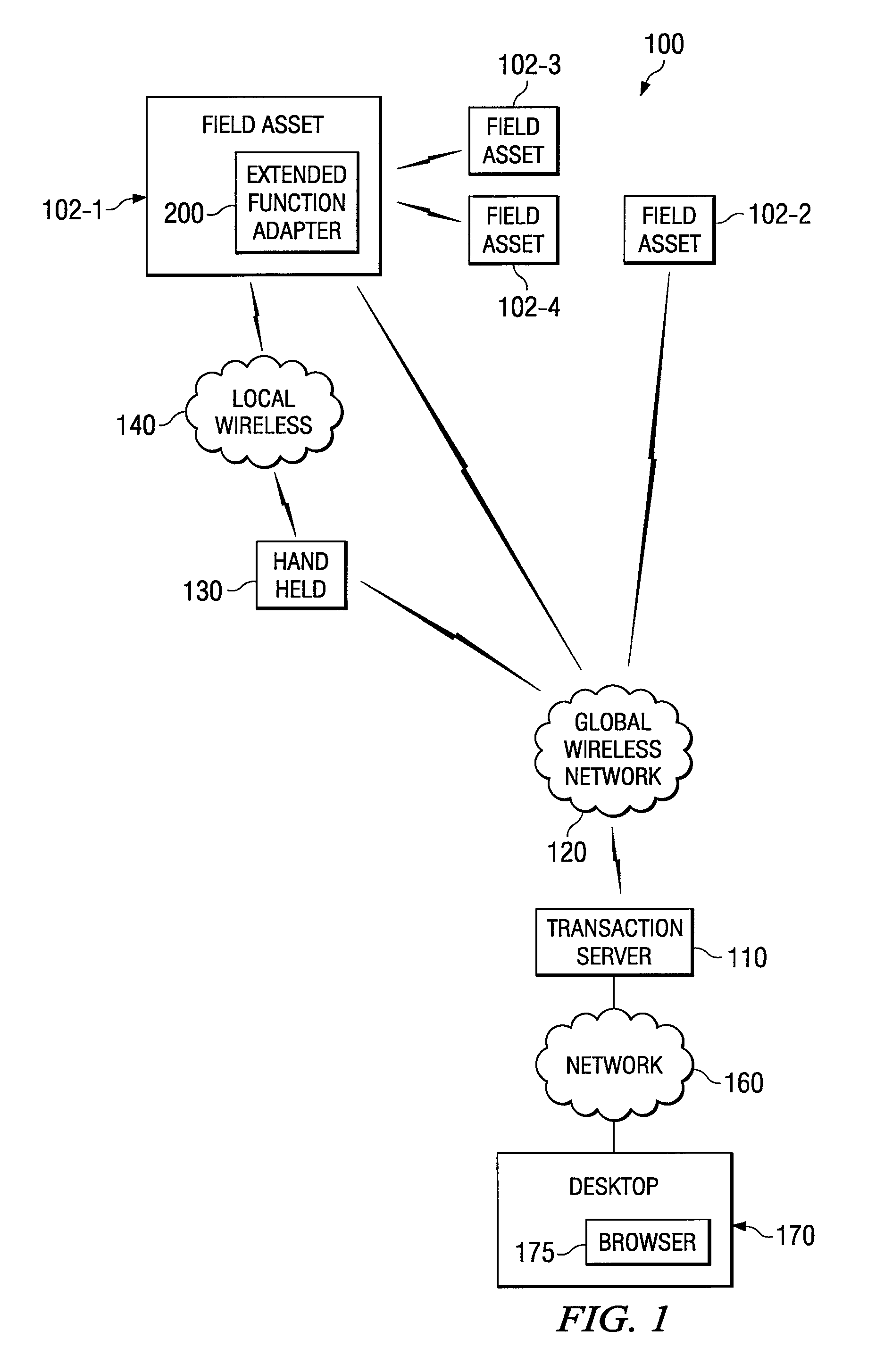

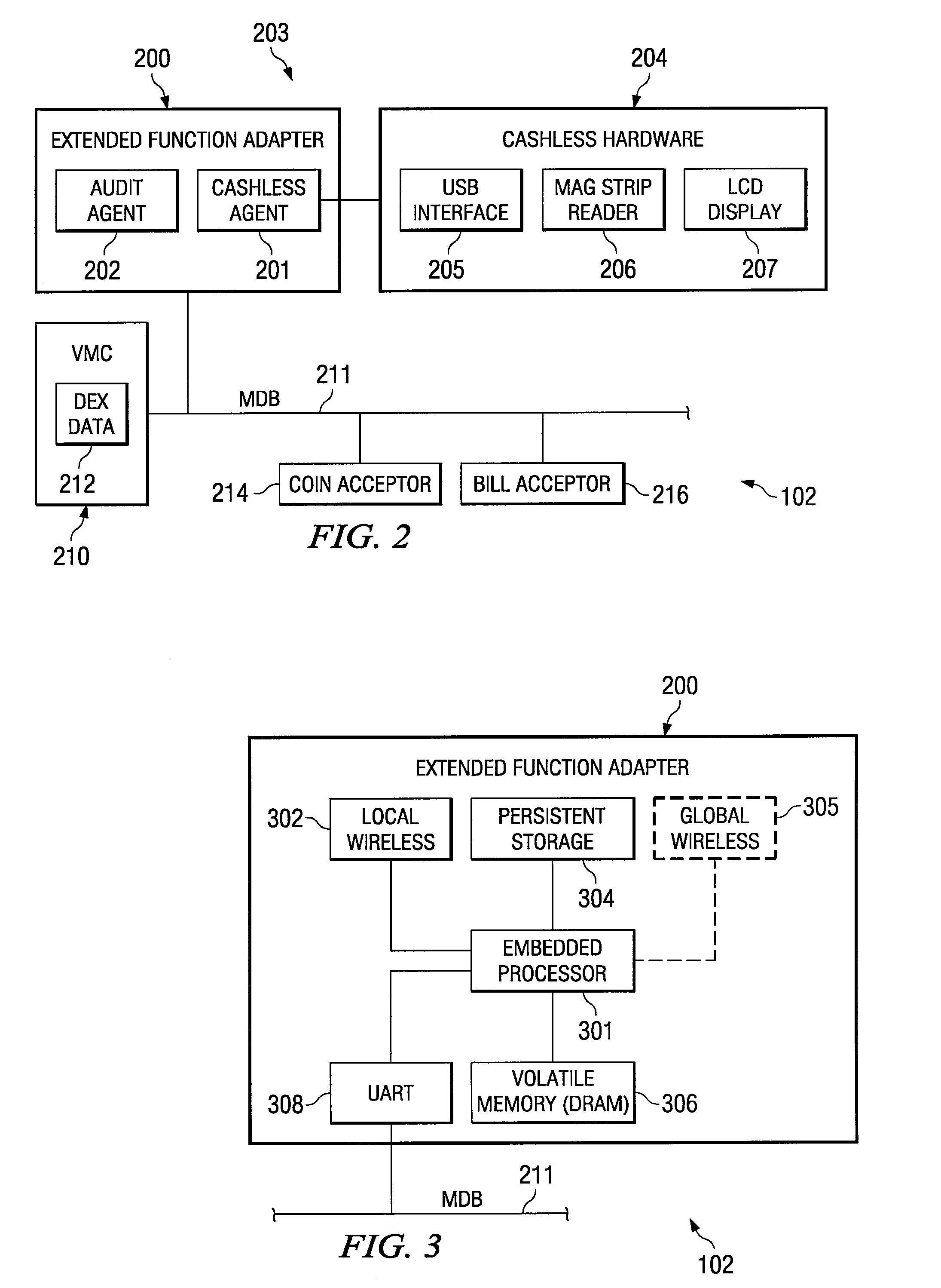

Processing Cashless Transactions of Remote Field Assets

InactiveUS20070187491A1Convenient transactionFast and reliable and inexpensiveFinanceVerifying markings correctnessFinancial transactionCard reader

A field asset for use in a machine to machine environment that includes a plurality of field assets in communication with a remote transaction processing server may comprise a card reader and an extended function adapter (EFA). The card reader may detect a cashless payment card presented to the card reader and the EFA may facilitate a cashless transaction in response to presentment of the cashless payment card to the card reader. The EFA may be operable to locally authorize the cashless transaction based on locally stored transaction information if said field asset lacks connectivity to the remote transaction processing server and may further be operable to remotely authorize the cashless transaction based on remotely stored transaction information if the field asset has connectivity to the remote transaction processing server.

Owner:CRANE MERCHANDISING SYSTEMS

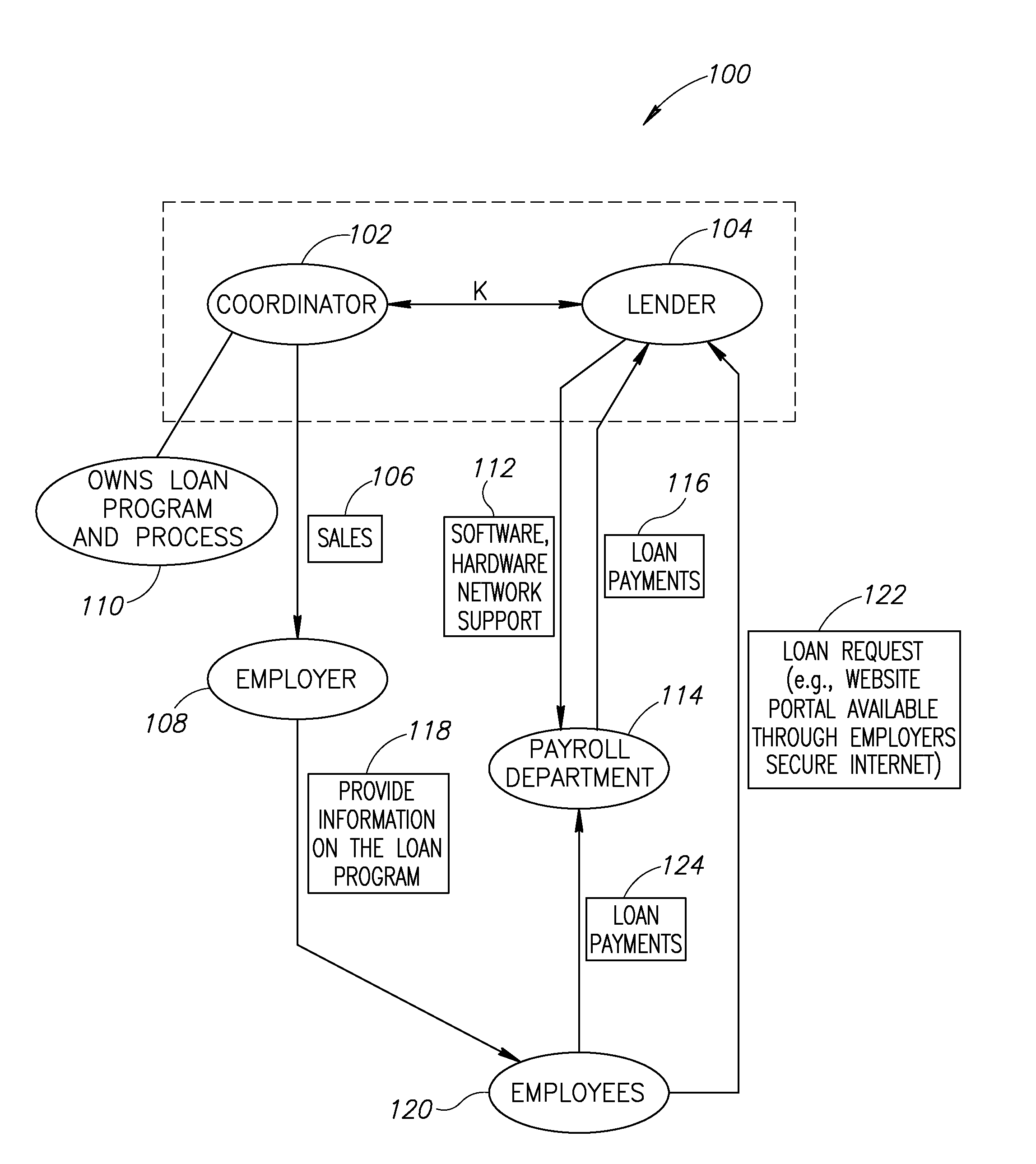

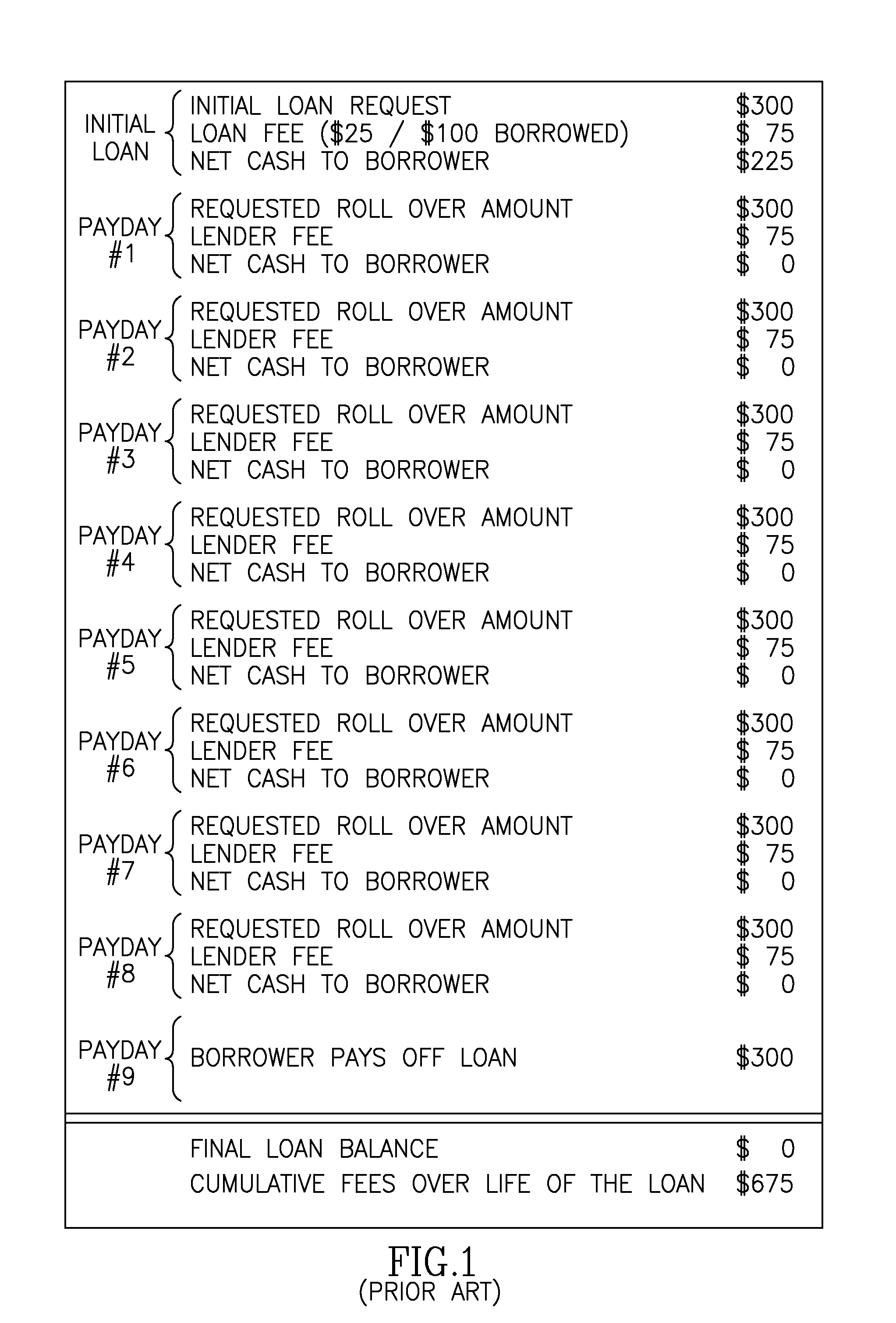

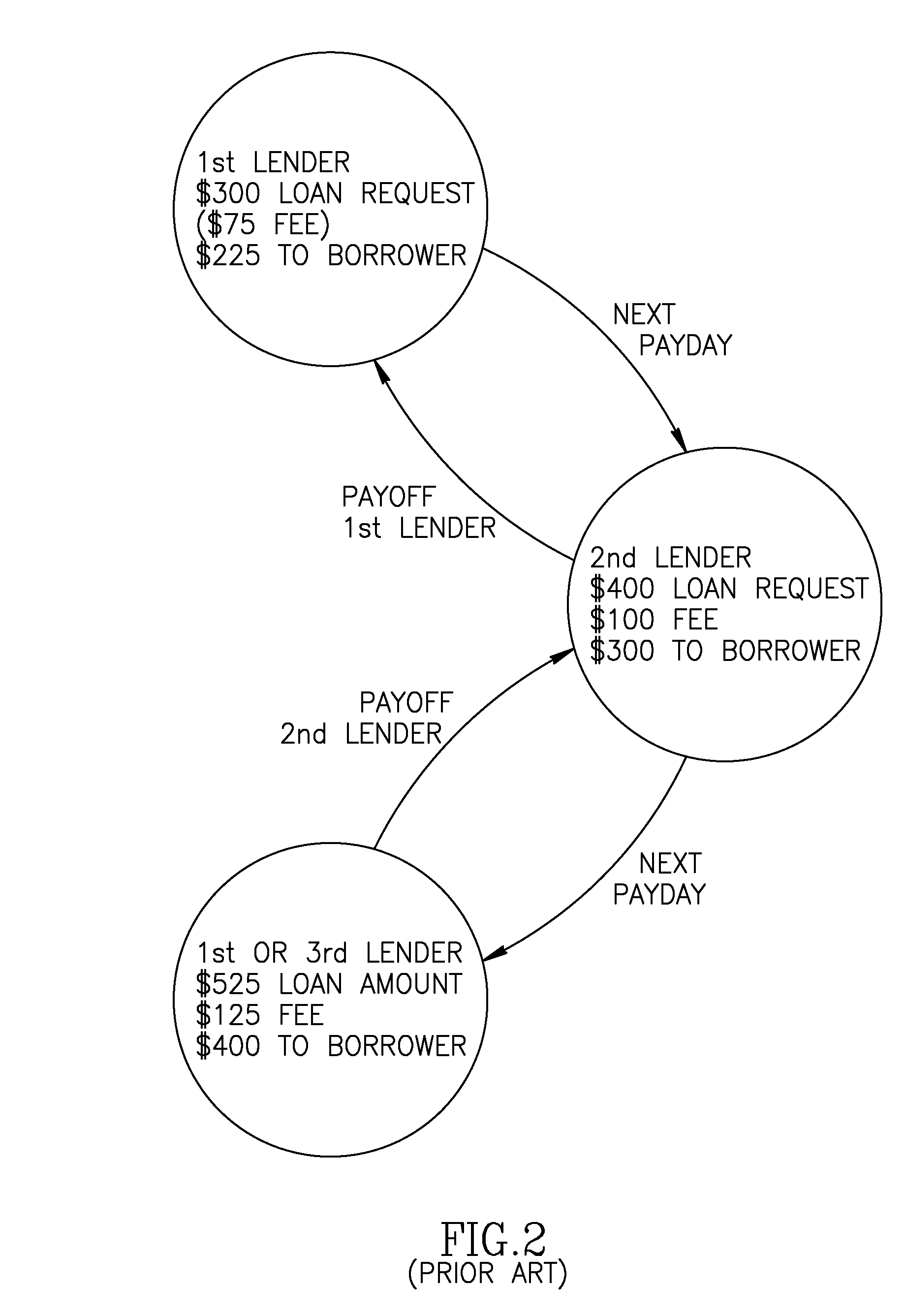

Loan program and process for transacting the same

InactiveUS20070271178A1Reduce representative outstanding loan balanceLow costFinancePayment architectureTelecommunicationsProgram planning

A loan program and process is structured to provide a significant end-to-end cost savings while overcoming many, if not all, of the drawbacks and regulatory obstacles present in the current payday loan industry. The program, the end-to-end process, and the arrangement thereof, permits a lender to offer short-term, small cash loans to employees through an employer controlled payroll system. Access to the employer controlled payroll system is achieved through an agreed upon relationship between a coordinator, a lender, and the employer. As part of the agreed upon relationship, the lender guarantees that all fees, interest, and other ancillary costs over and above a principle amount of the short-term, small cash loan will be kept at or below a predetermined annual percentage rate (APR). In addition, the loan is repayable over a number of payroll cycles such that each successive payday the principle balance of the loan decreases.

Owner:EMPLOYEE LOAN SOLUTIONS LLC

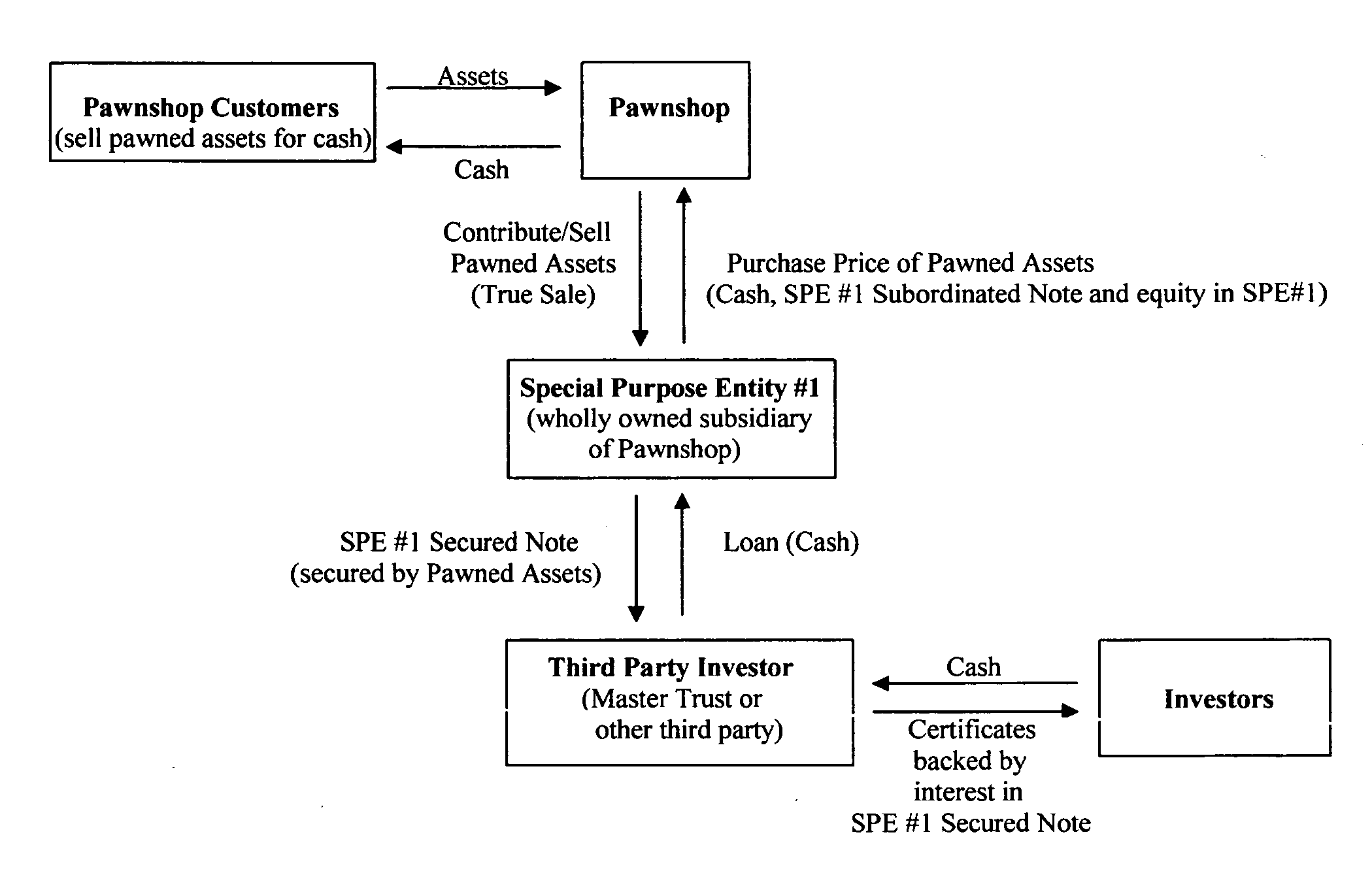

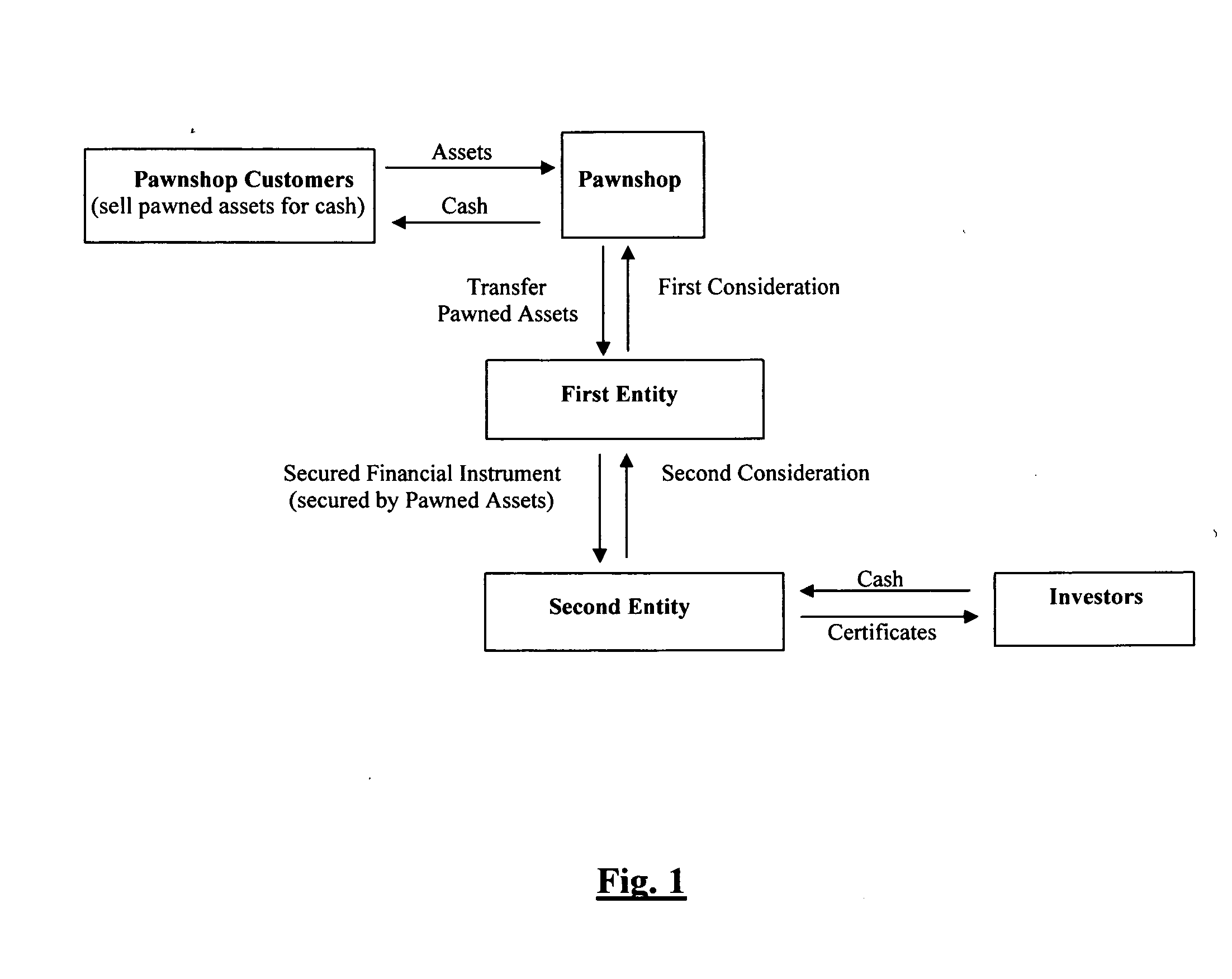

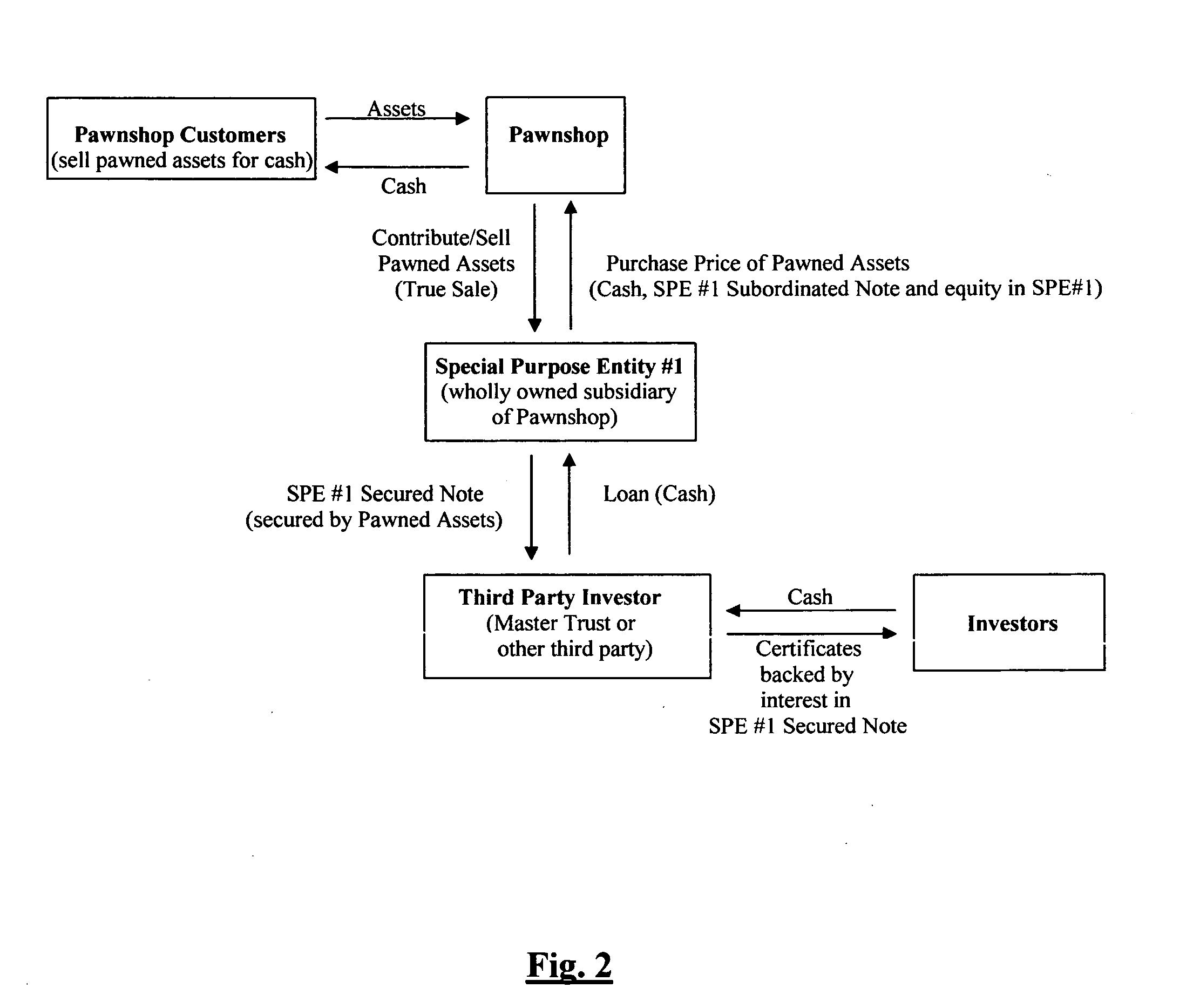

System and method for securitizing tangible assets in the alternative financial services industry

InactiveUS20060293985A1Significant comprehensive benefitsAvoids conflicting lenderFinanceComputer scienceFinancial transaction

Owner:SECURITIZATION GROUP

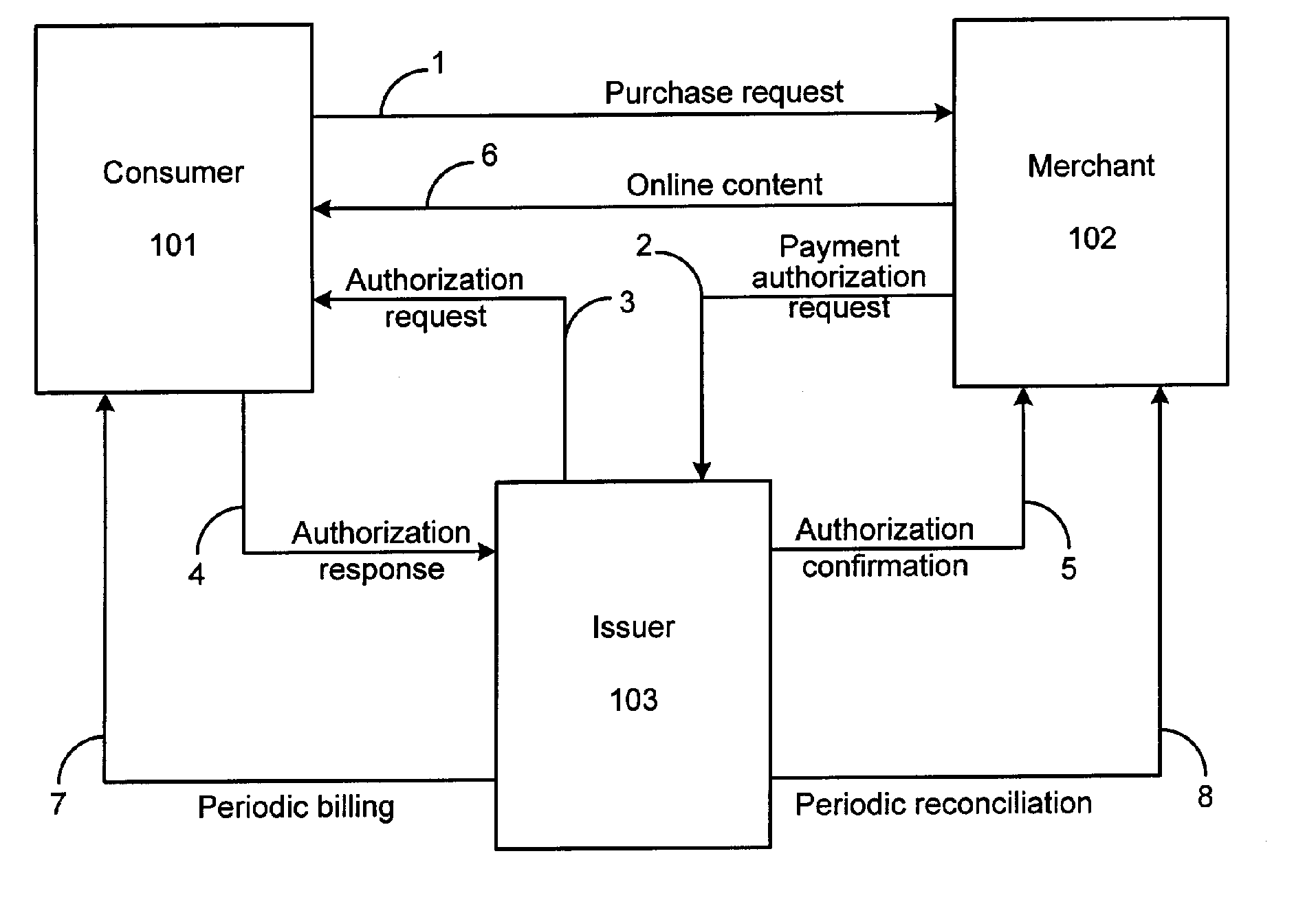

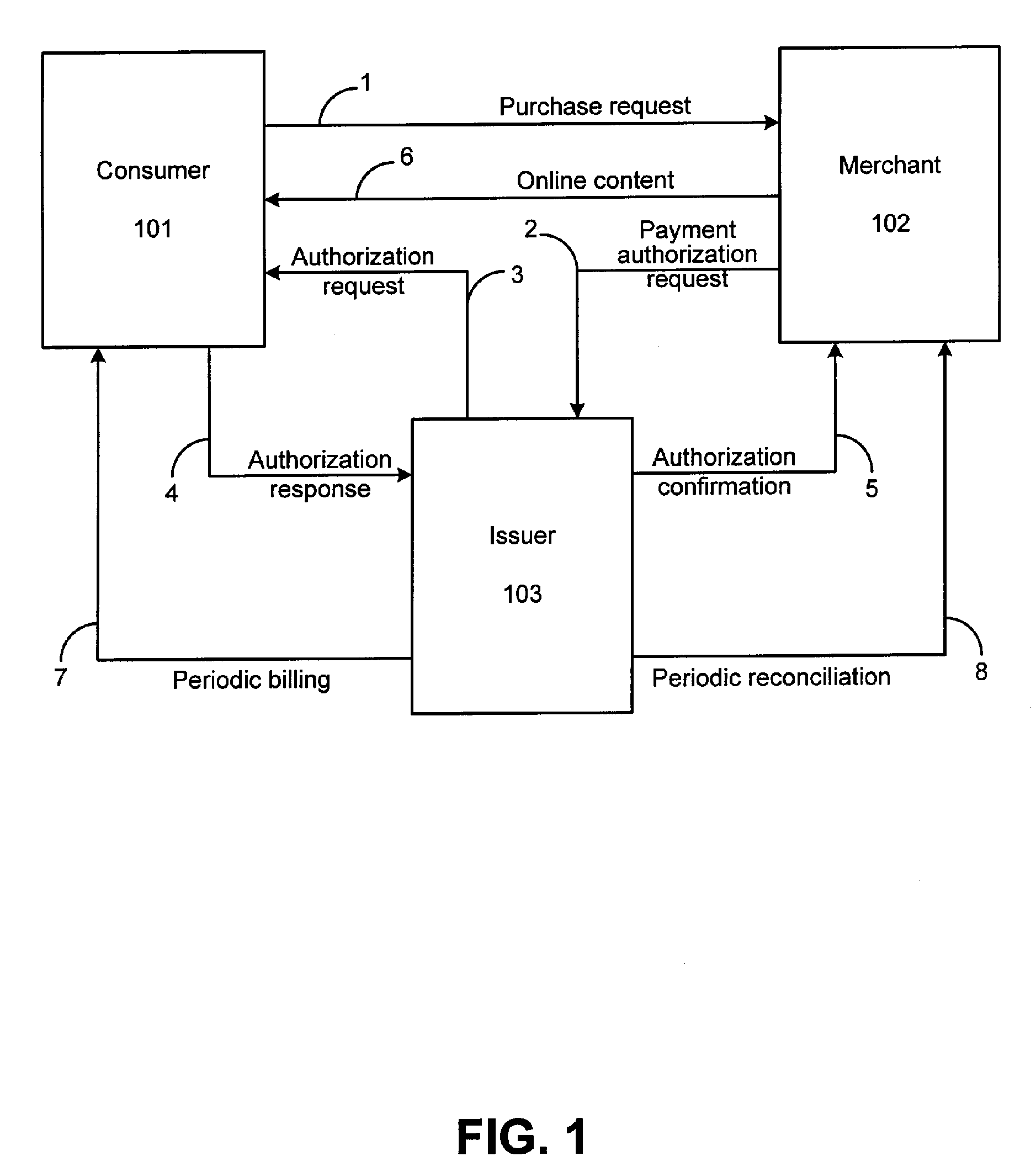

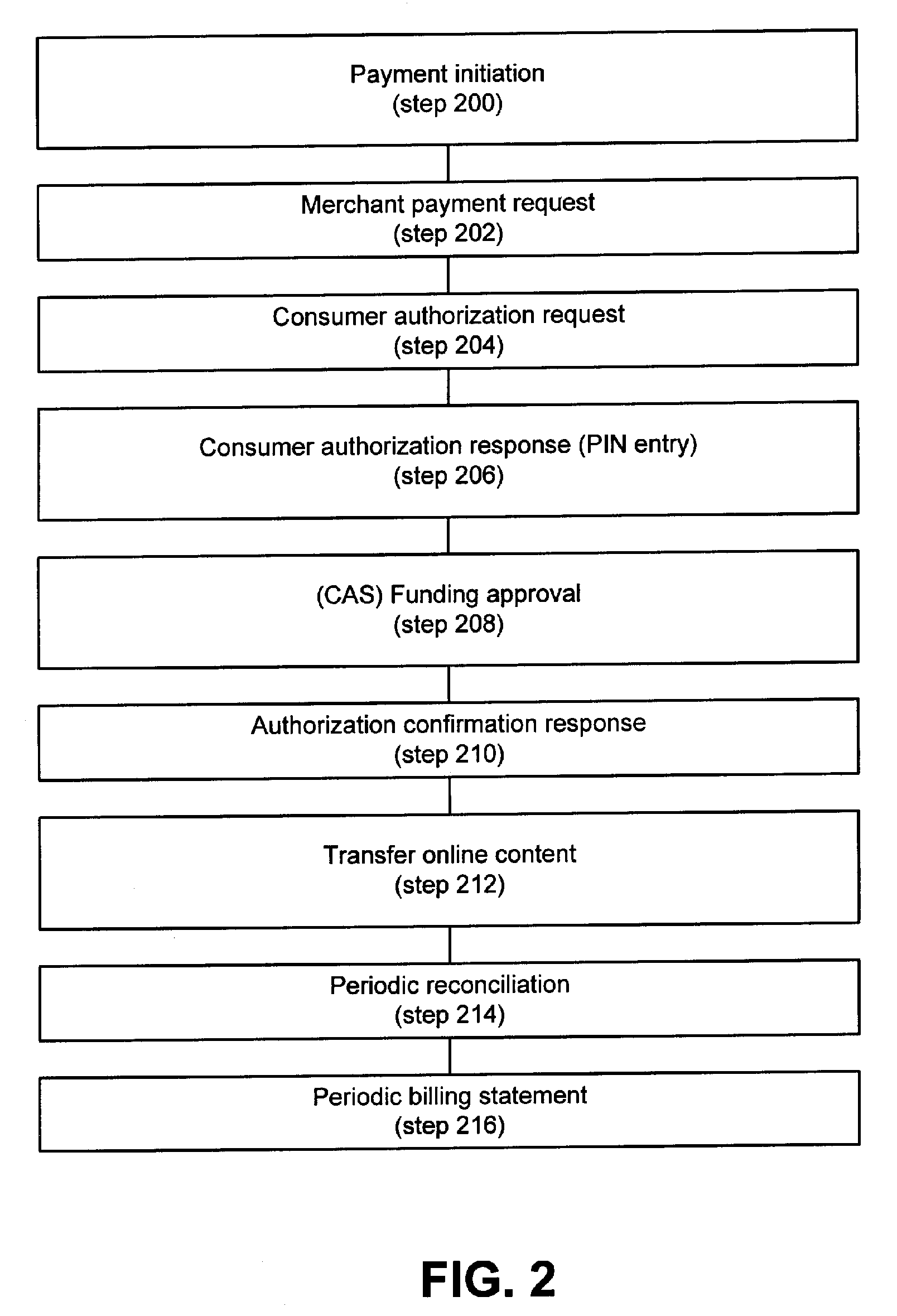

System for facilitating online electronic transactions

ActiveUS7210620B2Facilitates secure online content micropaymentsWell formedComplete banking machinesFinancePaymentWeb service

The invention provides systems and methods within existing business and technology infrastructures and processes for facilitating an electronic transaction including payment by an account issuer to a merchant for online purchases by a consumer. The invention uses a web services model including request and response messages to provide simplified authentication and authorization through entry of the consumer's PIN, without the release of the consumer's account or billing information to the merchant. The invention reduces authorization processing, and reduces the transaction fees for online transactions, increasing the viability of lower value transactions.

Owner:AMERIPRISE FINANCIAL

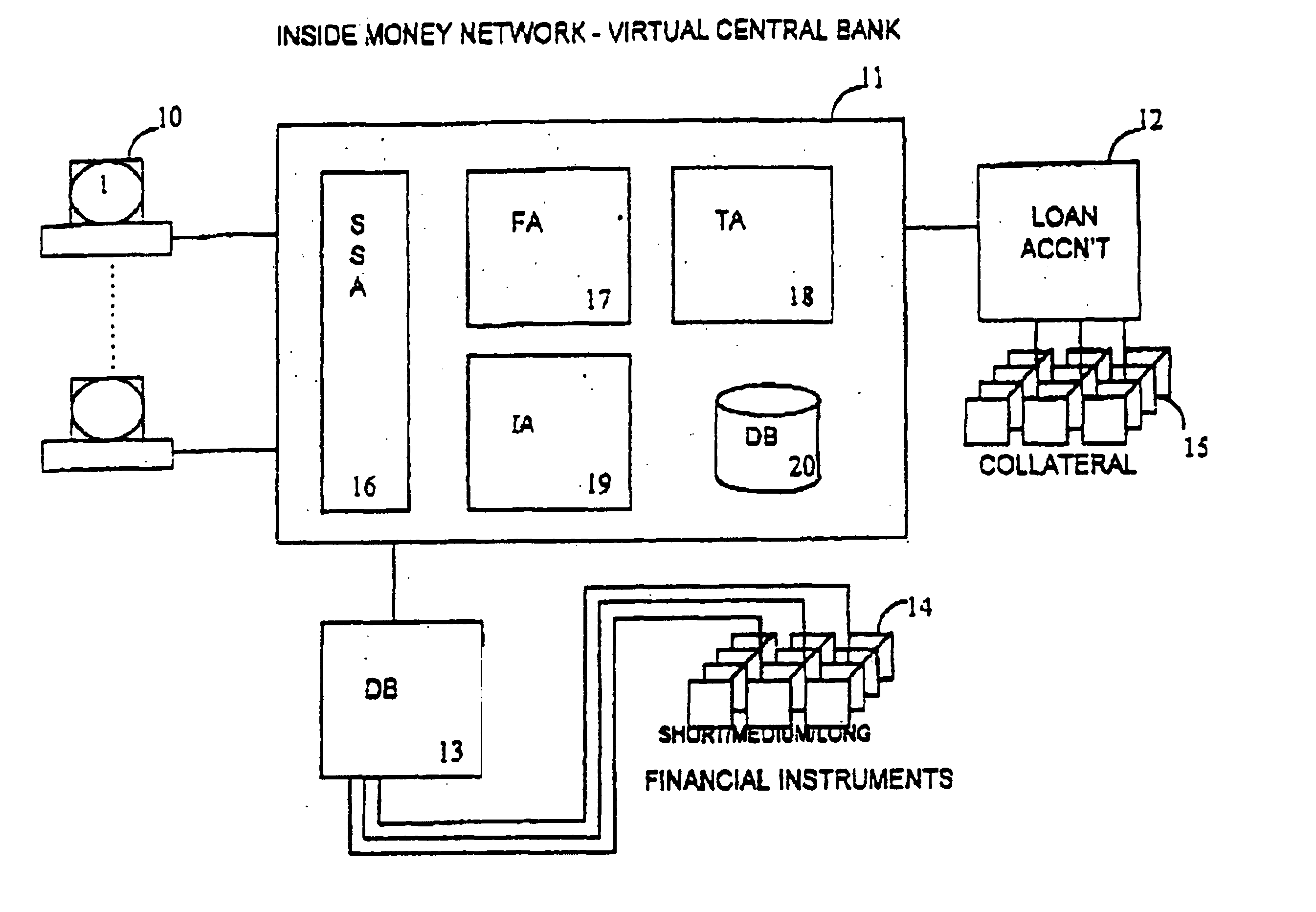

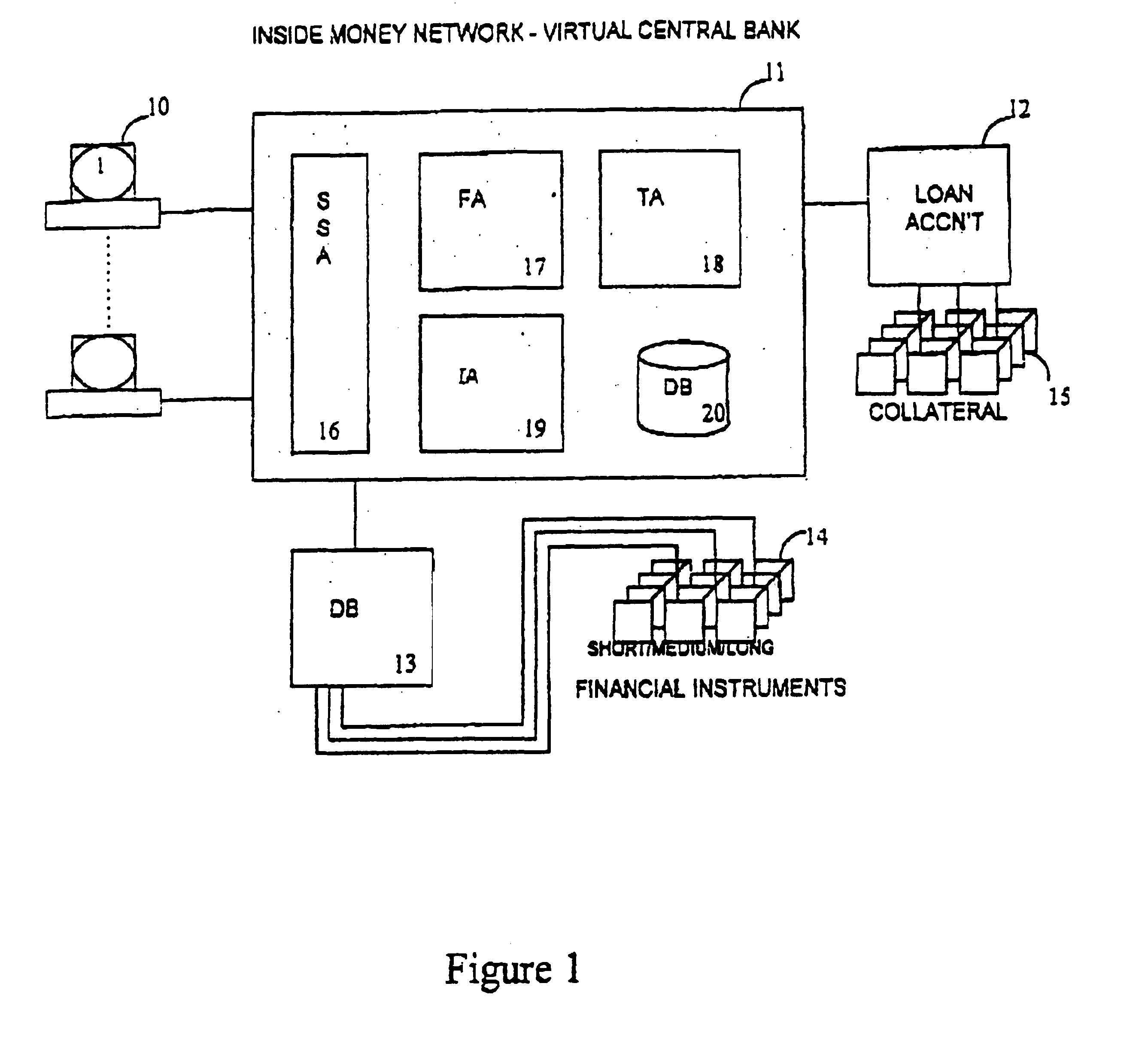

Inside money

InactiveUS7020626B1Saves transaction costHigh returnAcutation objectsFinanceComputer scienceData bank

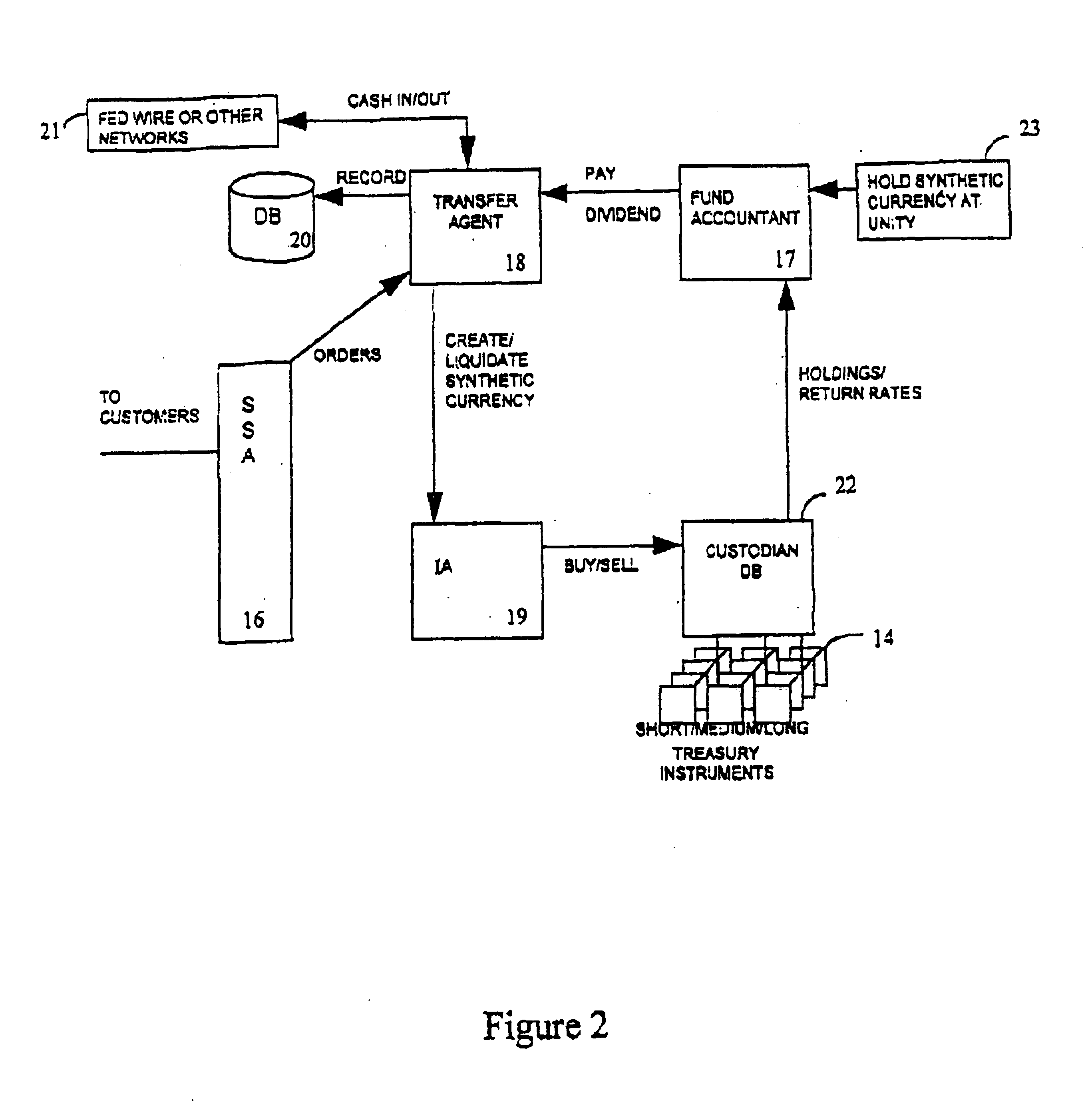

A synthetic currency transaction network which performs transactions with near real time finality of transaction between potential borrowers and potential lenders. Synthetic currency is created by pooling and dividing into shares a portfolio of highly liquid assets and frequent evaluation and disbursements of dividends on those assets so as to hold the value of the synthetic currency share at unity with the underlying currency. The synthetic currency network provides for interfacing users to the synthetic currency transaction network. A database is used for storing and maintaining records and other information of the network. A transaction manager manages network users' accounts and all network transactions. A fund accountant manages network information regarding the synthetic currency. A deposit bank acts as custodian for the portfolio of highly liquid assets which underlie the synthetic currency. An investment manager manages the measure of synthetic currency and directs investment decisions. A loan accountant manages all lending and borrowing activities in the synthetic currency transaction network.

Owner:CITIBANK

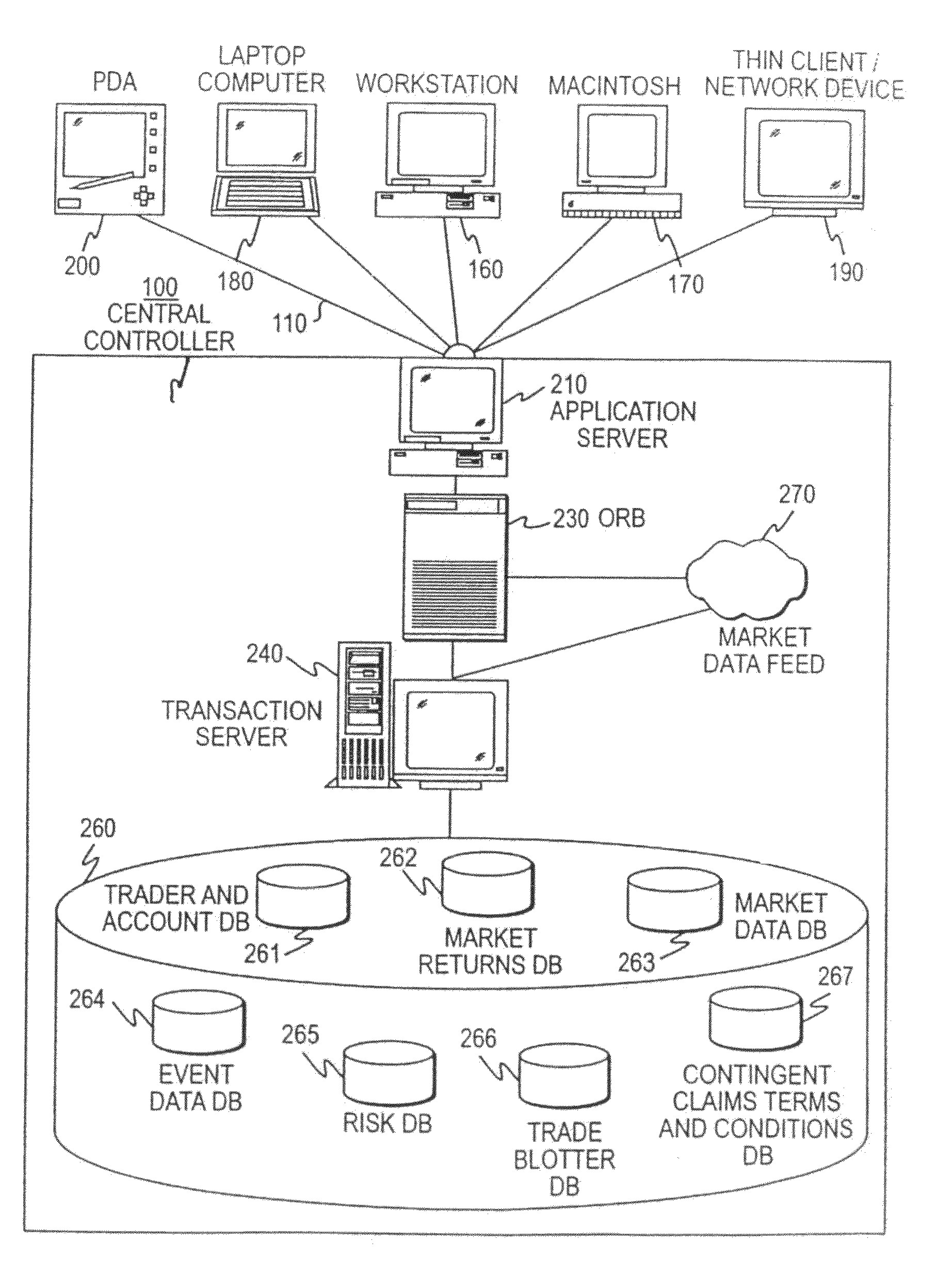

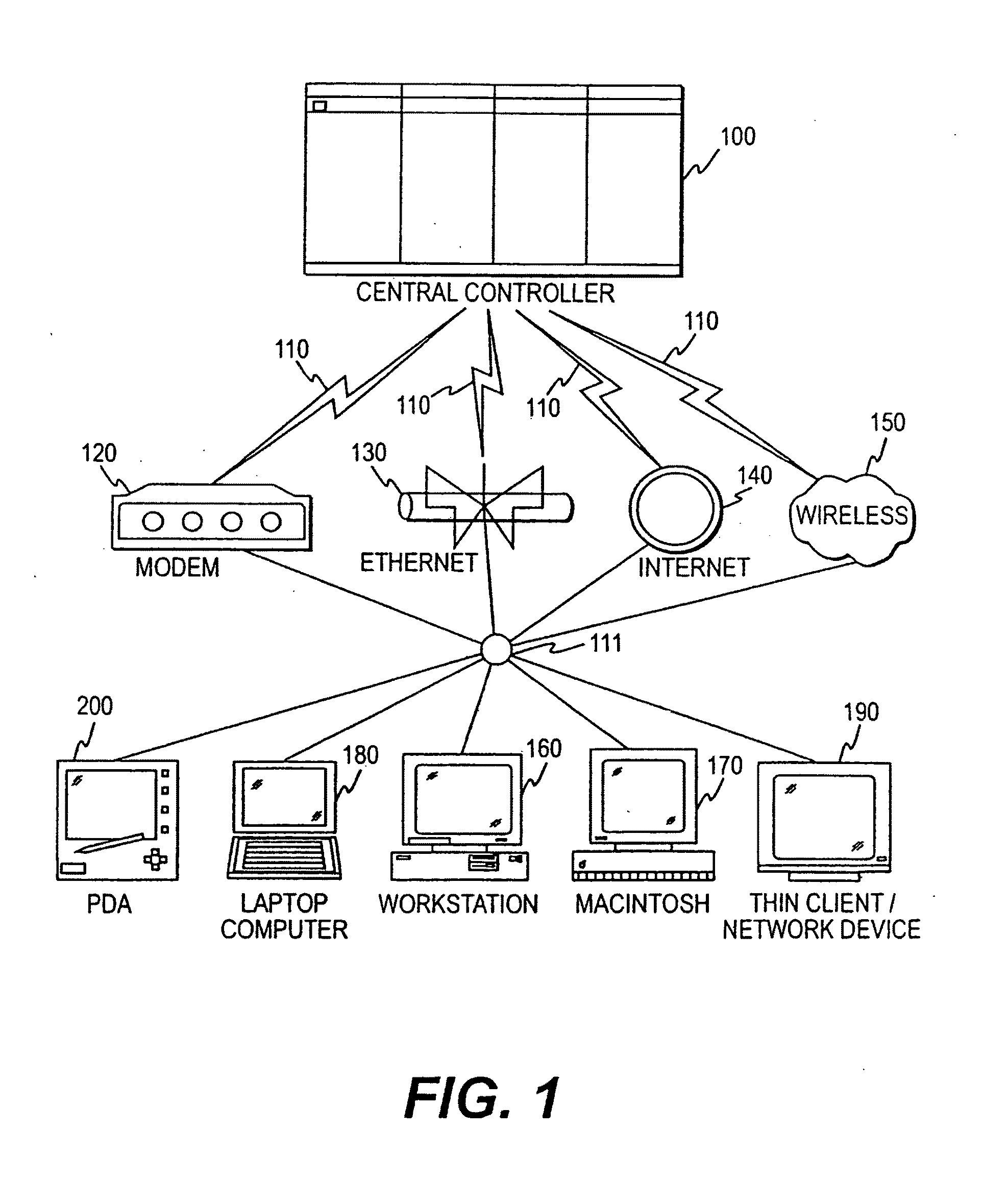

Digital options having demand-based, adjustable returns, and trading exchange therefor

InactiveUS7996296B2Reduce transaction costsFinanceApparatus for meter-controlled dispensingEngineeringMonetary Amount

Owner:LONGITUDE LLC

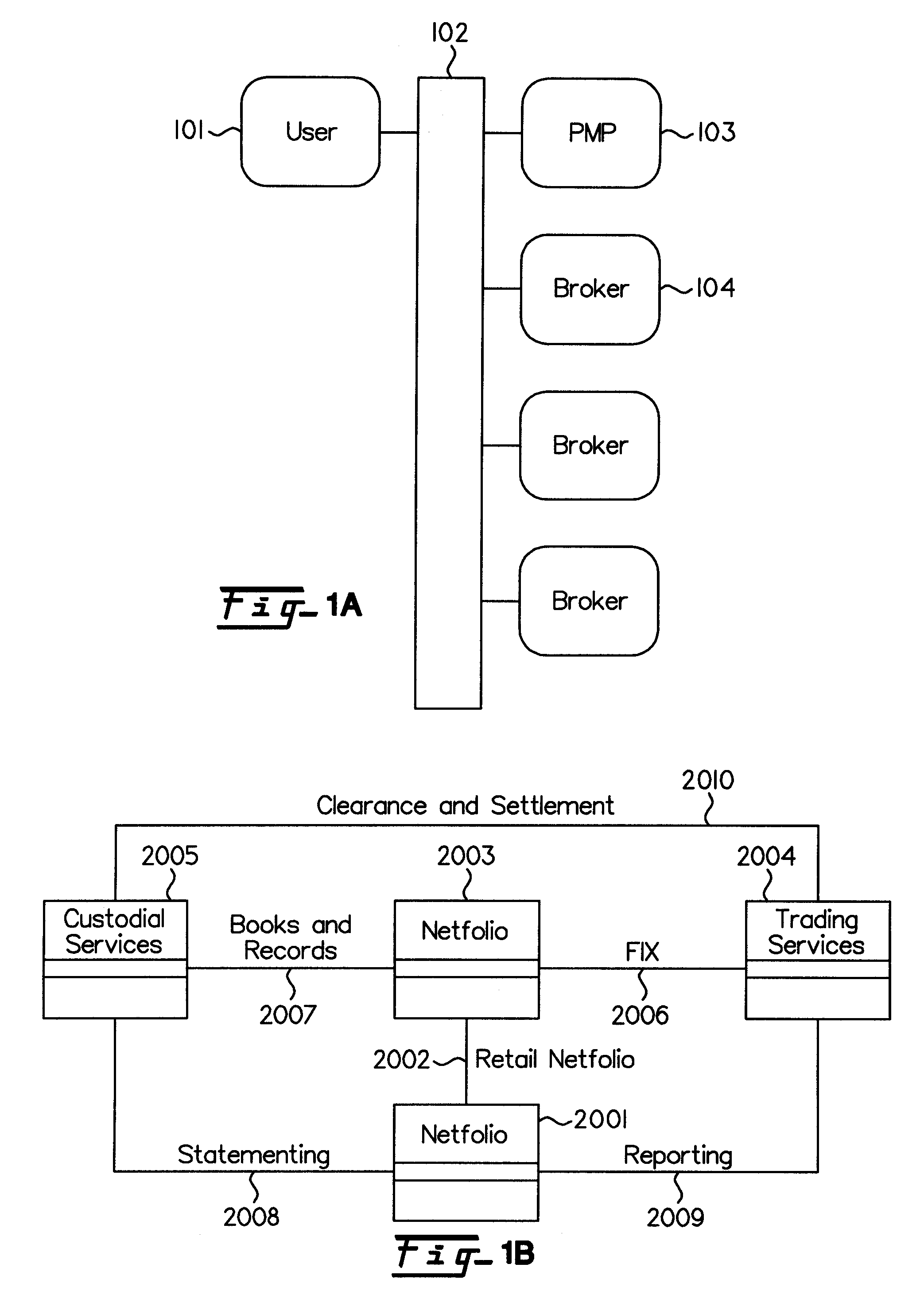

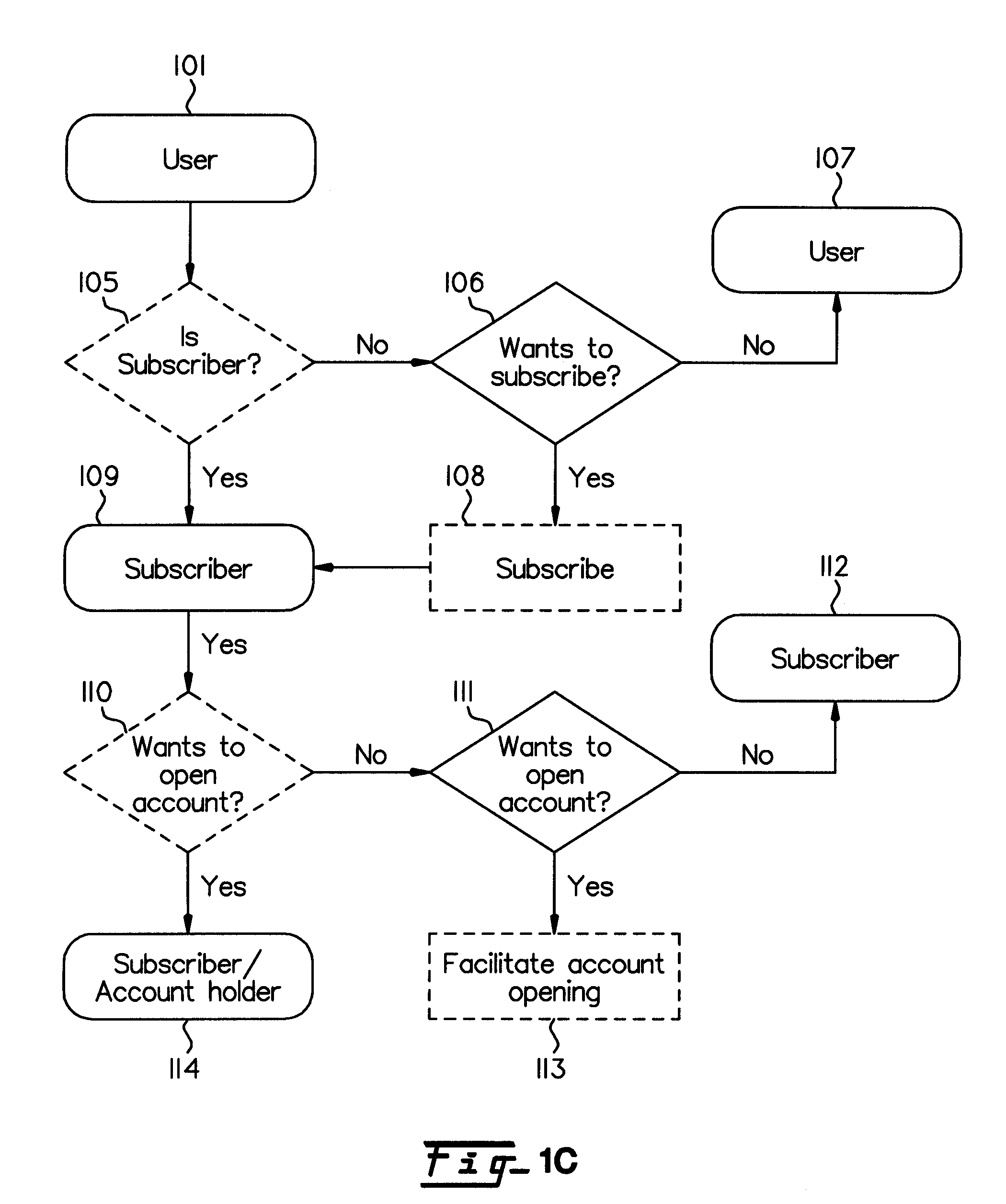

System and method for selecting and purchasing stocks via a global computer network

InactiveUS7177831B1Low costLow efficiencyComplete banking machinesFinanceProject portfolio managementPayment

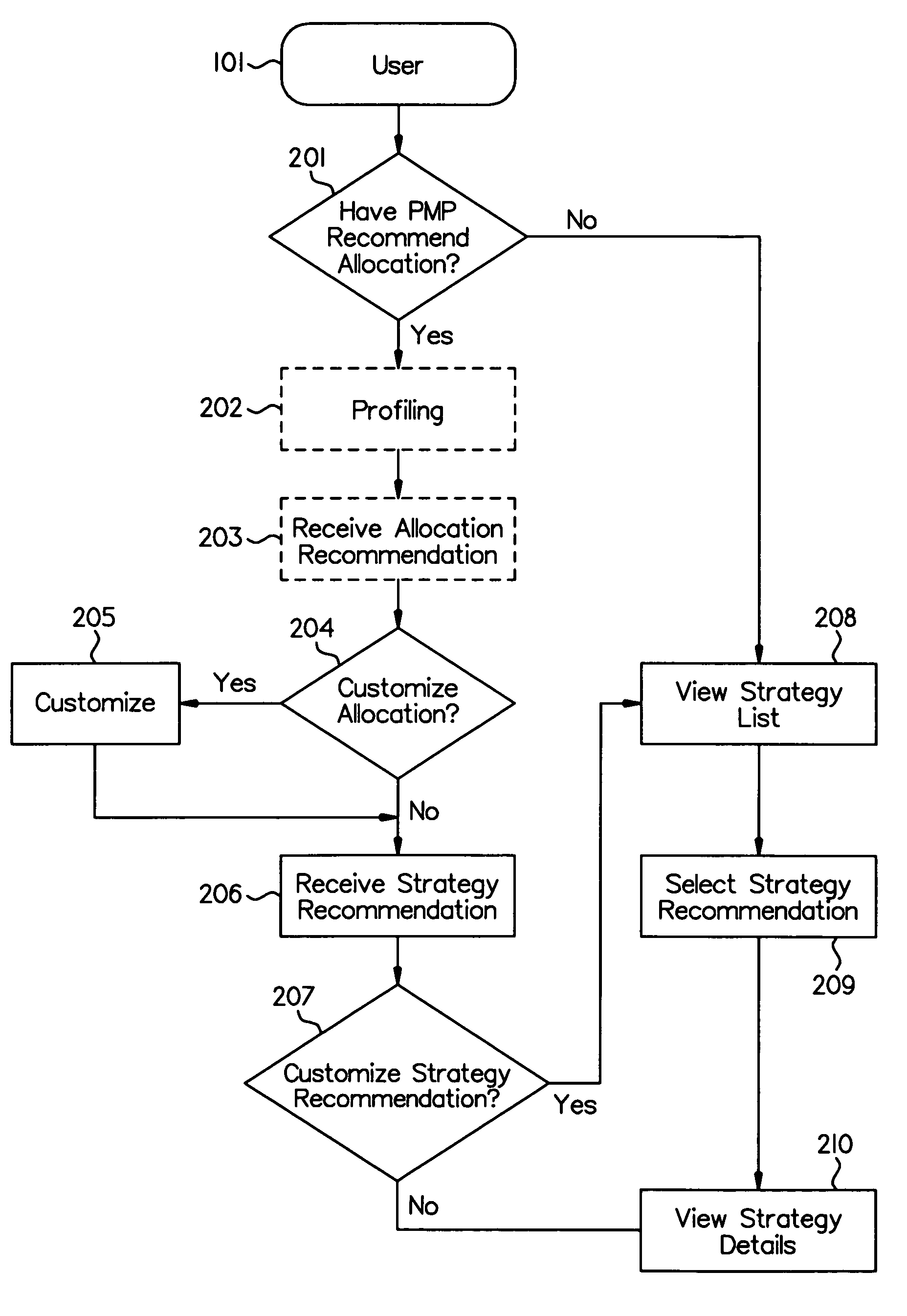

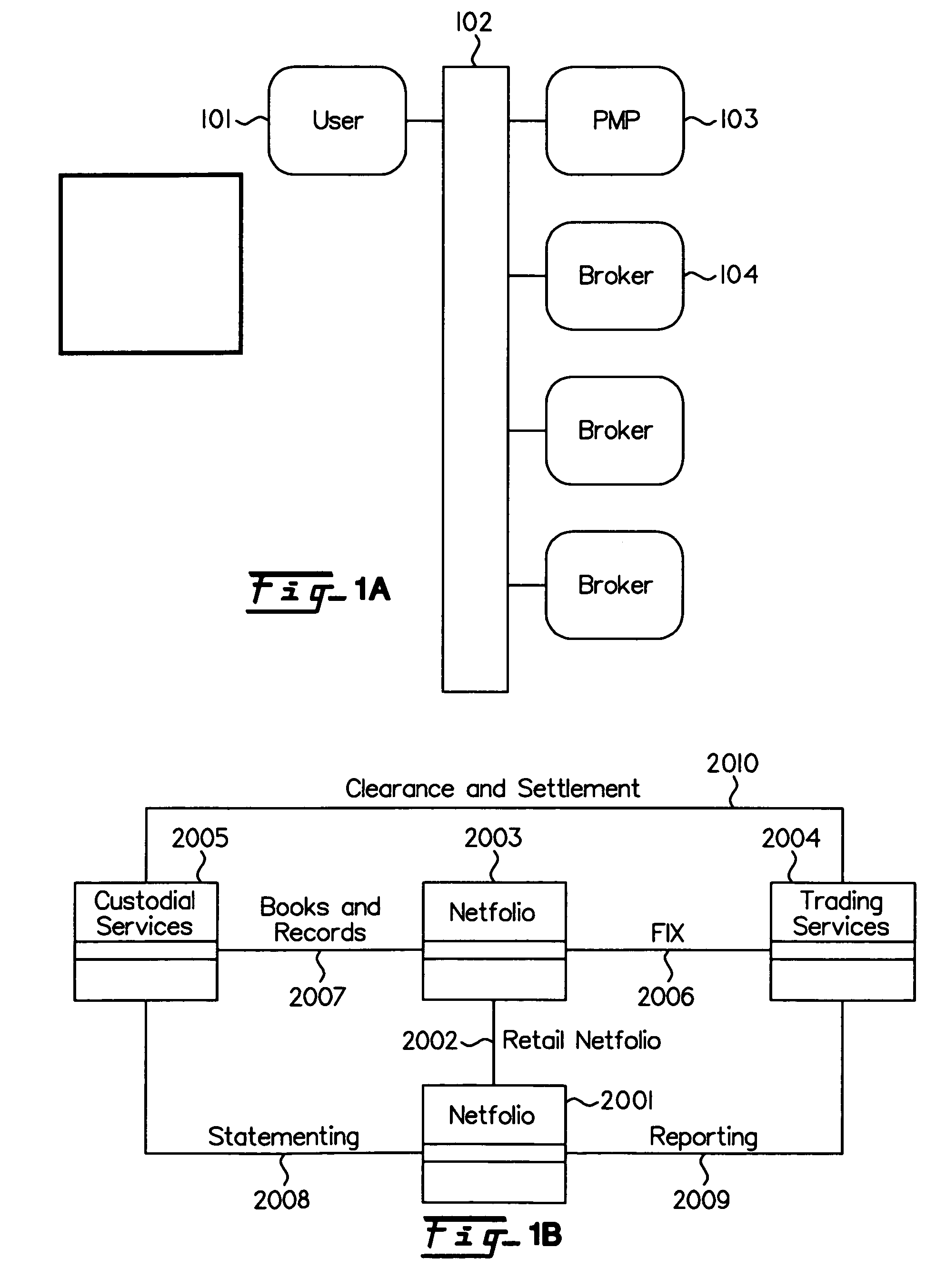

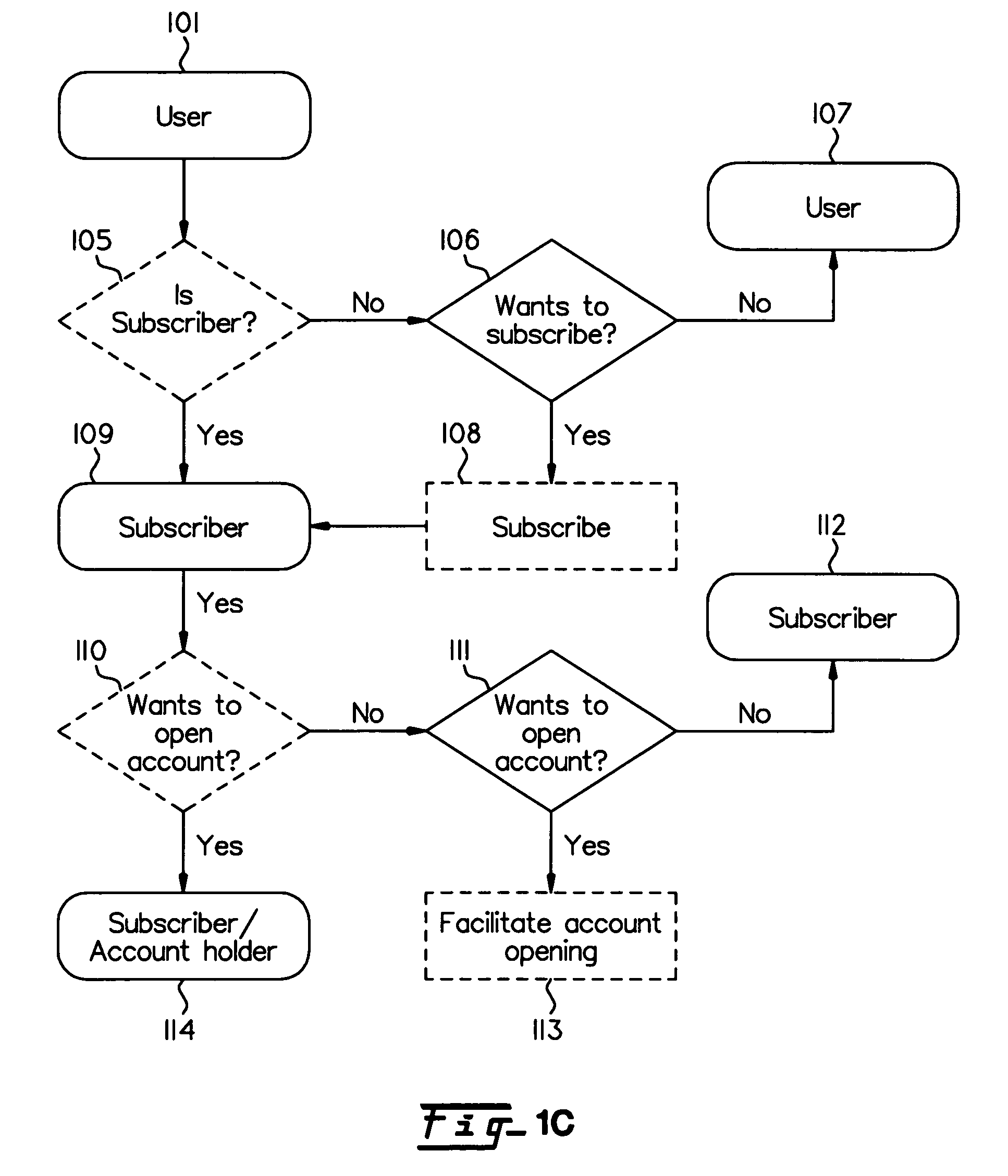

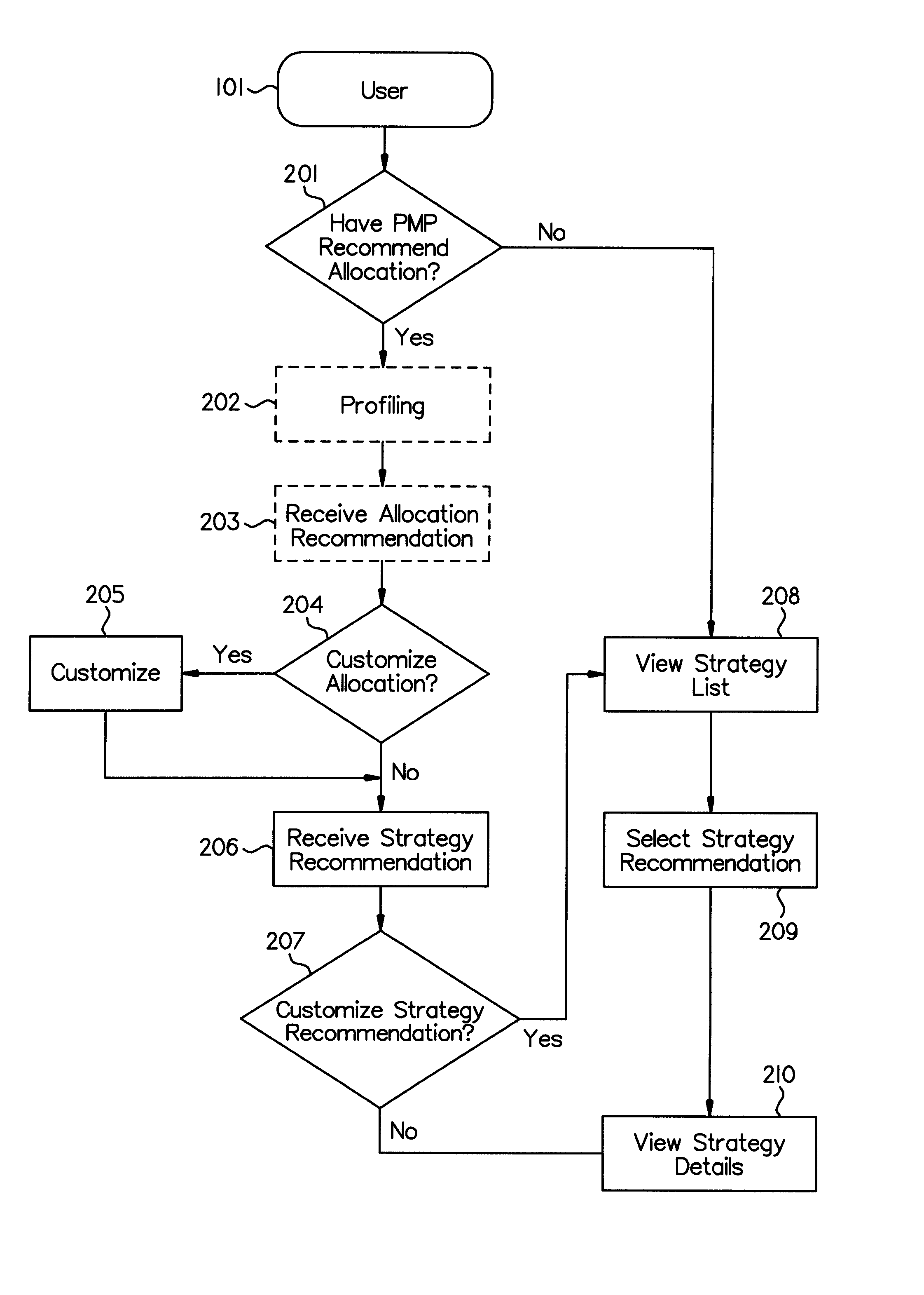

The invention is in the field of using a computer to provide automated investment allocation advice, selection of investment securities, customization of the automated advice, execution of investment securities, maintenance / monitoring of investment portfolios and rebalancing of investment portfolios. A user is connected to the Internet. The user connects to the portfolio management program (PMP) host computer through the Internet. The user completes a questionnaire that the PMP uses to generate a suitable investment allocation and specific portfolio strategy recommendation. The user reviews the strategy and specific information about the strategy. The information is transmitted across the Internet to the user. The information transmitted includes historic and / or hypothetical performance, historical and / or hypothetical holdings, current securities selections of the strategy, and a description of the strategy's selection methodology. The user, after making appropriate reviews, makes a decision to purchase the instruments in that portfolio. Now the user sees a list of instruments provided by the PMP host computer. The list of stocks is ordered by the degree to which they satisfy the requirements of the strategy. The user can then make the decision whether to accept, reject, or replace any individual security in the generated list or add an individual security. For example, the user can reject a security in the strategy and ask the PMP host computer to replace it with the next security that best fits. Once the user has approved the content of the proposed portfolio, the user enters an amount that the user will invest in accordance with the strategy. The PMP will allocate the investment amount across all the securities in the strategy. The user may authorize the PMP to purchase these selections through their qualified broker. The user may monitor the performance of these instruments subsequent to purchase through the PMP. The user may receive news, alerts, and / or research related materials for these instruments through the PMP. The user may authorize the PMP to rebalance their investments periodically to an updated list of instruments matching the selected strategy. The user may select a rebalance method that optimizes the tax consequences or the strategy adherence. The user has the ability to accept, reject, or replace any individual security in the generated list or add an individual security as part of the rebalance. The user can set up automatic email notification of rebalance dates or to have the PMP vote the proxy of the shares. The owner of the PMP host computer collects a payment for this service.

Owner:NETFOLIO INC

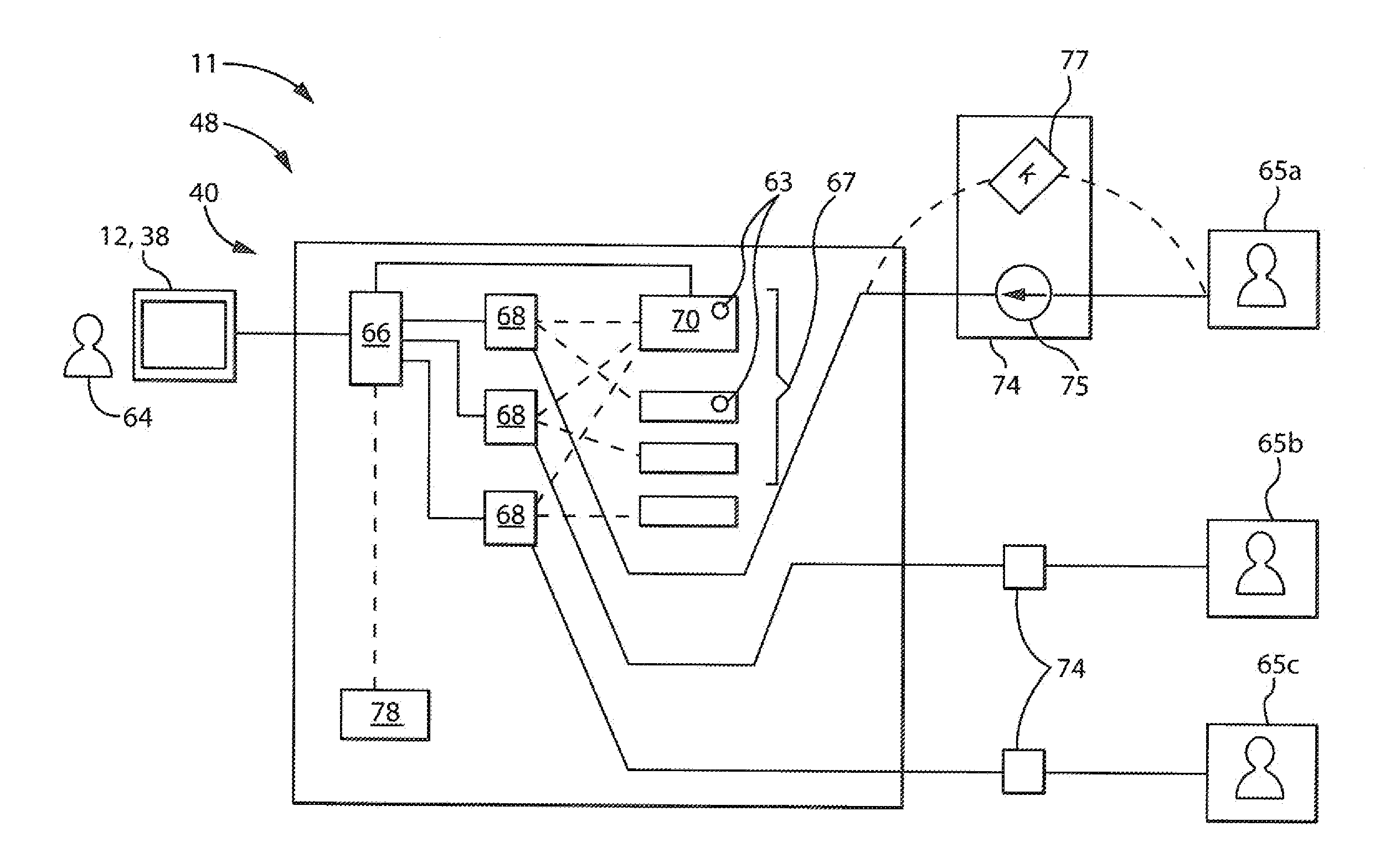

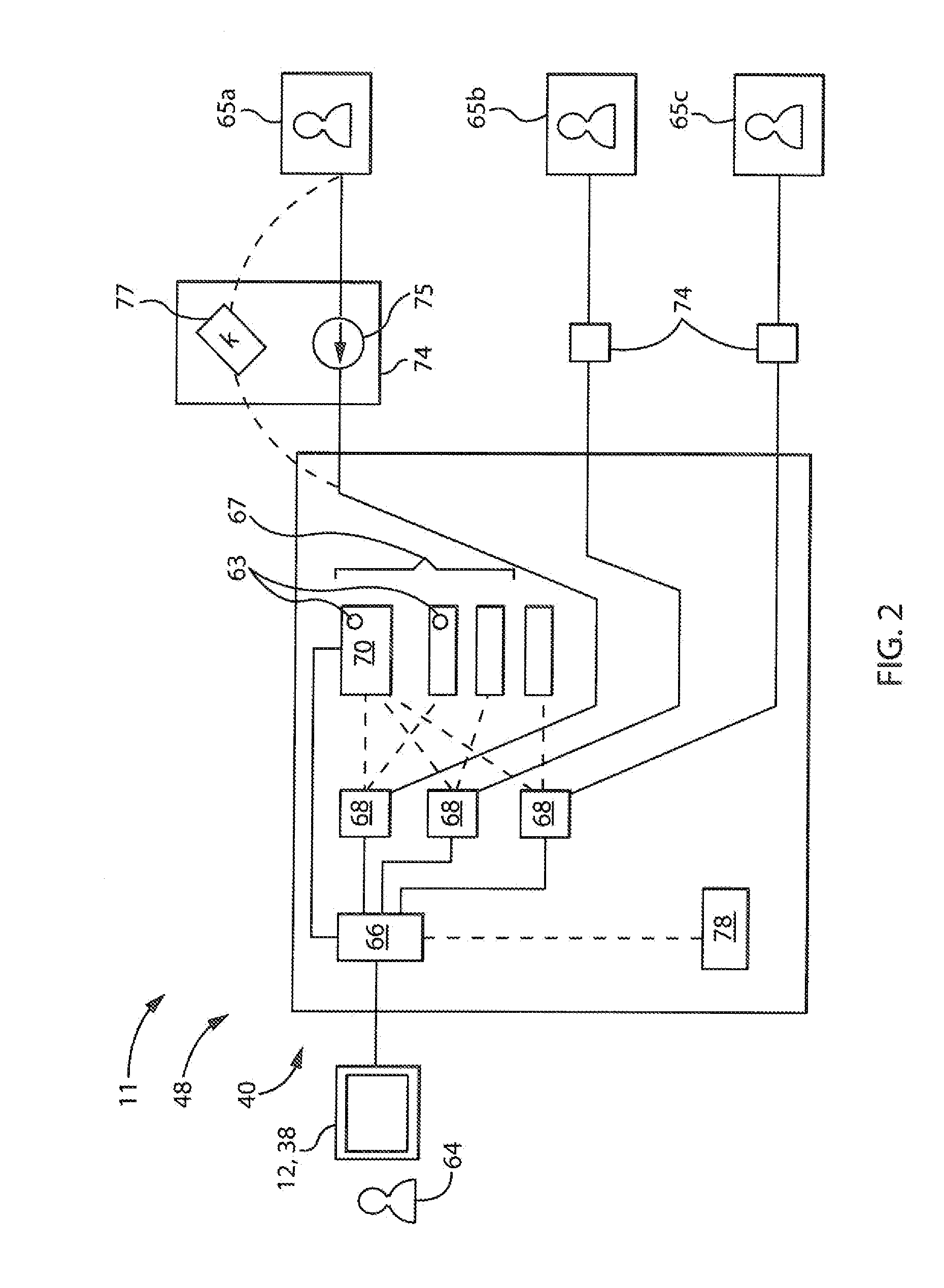

Method, Sytem and Business Model for a Buyer's Auction with Near Perfect Information Using the Internet

InactiveUS20080133426A1Reduce transaction costsProvide feedbackInput/output for user-computer interactionFinanceThe InternetMarket intelligence

A methodology, system and business model are disclosed for facilitating a fully automated buyer's auction in which the major types of transaction costs are significantly reduced by providing the buyer and the sellers with near-perfect information about one another, including information about buyer preferences and competing sellers' offers. The system implements a buyer's auction with multidimensional bidding that minimizes market intelligence, search, bargaining and transaction execution costs and thus creates more competitive, frictionless markets. Buyers and sellers can efficiently conduct the buyer's auction within a unified environment, thereby minimizing buyer integration costs as well. The buyer's auction generates commercially marketable proprietary information and a revenue stream for the auctioneer providing such a service.

Owner:PERFECT COMMERCE

Enhanced parimutuel wagering

InactiveUS20110081955A1Reduce transaction costsFinanceSemiconductor/solid-state device manufacturingCanis lupus familiarisComputer science

Methods and systems for engaging in enhanced parimutuel wagering and gaming. In one embodiment, different types of bets can be offered and processed in the same betting pool on an underlying event, such as a horse or dog race, a sporting event or a lottery, and the premiums and payouts of these different types of bets can be determined in the same betting pool, by configuring an equivalent combination of fundamental bets for each type of bet, and performing a demand-based valuation of each of the fundamental bets in the equivalent combination. In another embodiment, bettors can place bets in the betting pool with limit odds on the selected outcome of the underlying event. The bets with limit odds are not filled in whole or in part, unless the final odds on the selected outcome of the underlying event are equal to or greater than the limit odds.

Owner:LONGITUDE LLC

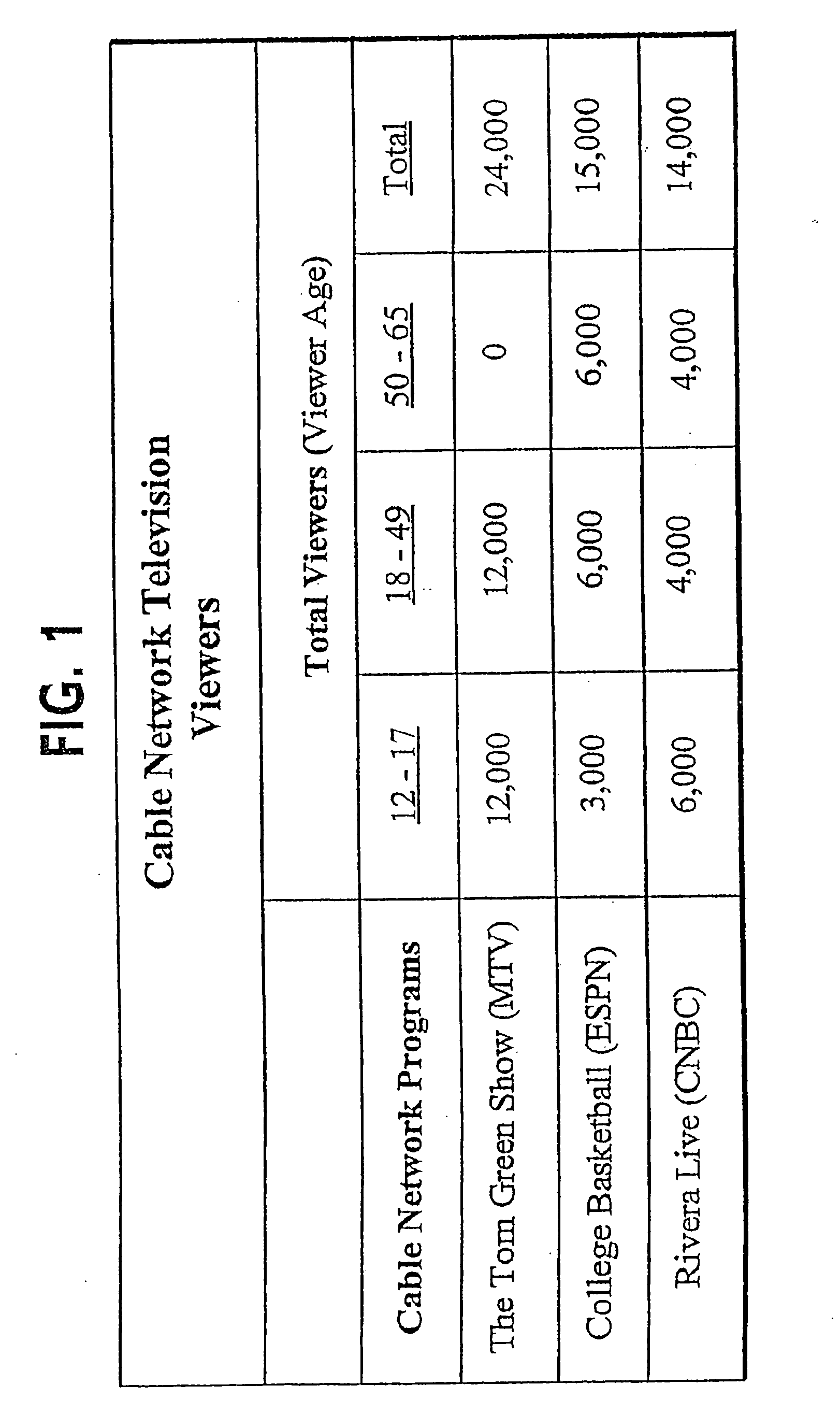

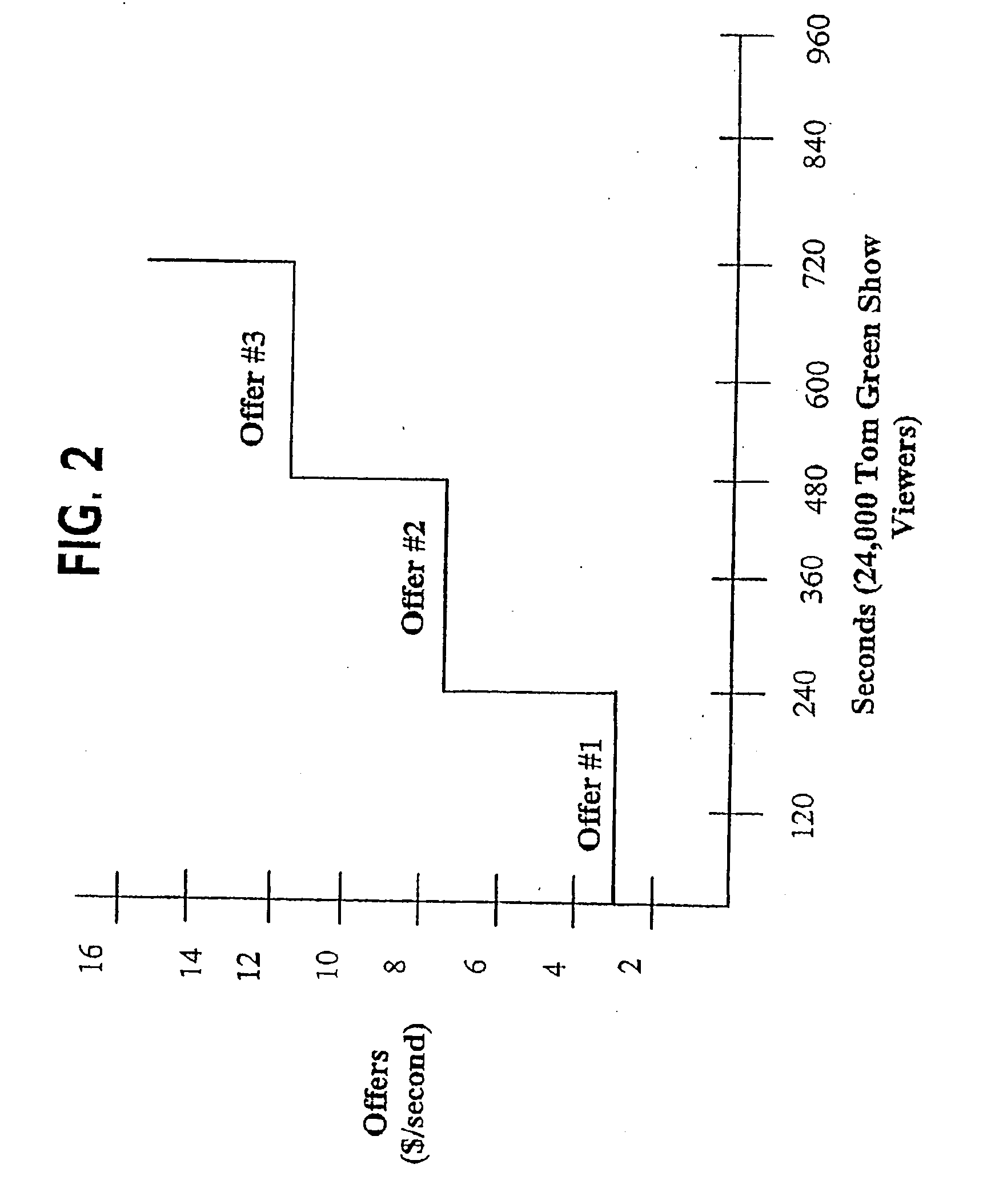

Automated exchange for the efficient assignment of audience items

InactiveUS20070288350A1Increasing amount and qualityOptimize the gains from tradeFinanceAdvertisementsLibrary science

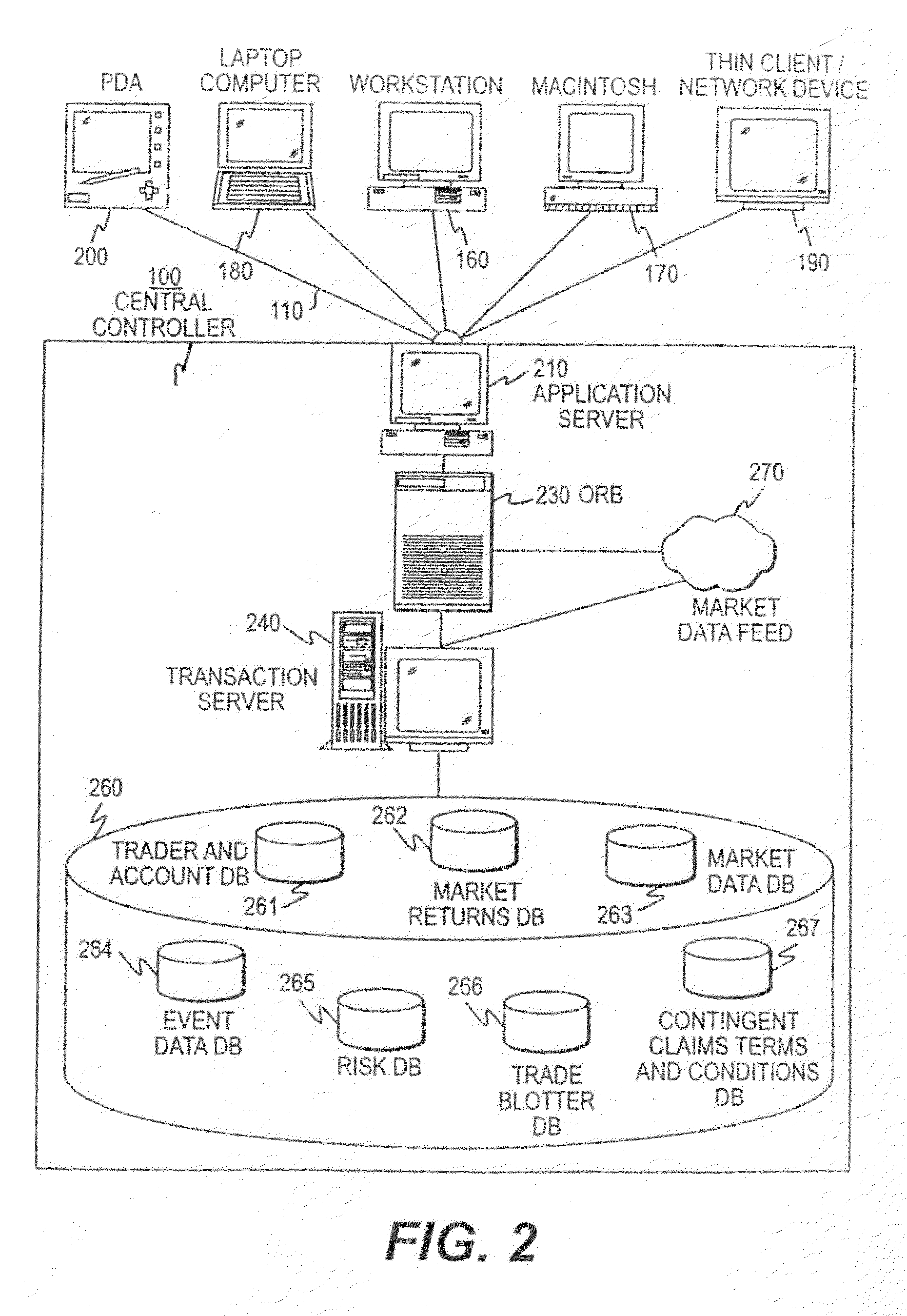

An automated exchange system is provided which includes a smart electronic double auction for allocating audience items among prospective buyers and sellers and for calculating a set of prices for the audience items based on buyer bids from the buyers and seller offers from the sellers, including remote terminals for initiating and transmitting data including buyer bids and seller offers; and a central trade exchange system including a trading means for receiving buyer bids and seller offers from said remote terminals, simultaneously processing the buyer bids and the seller offers, identifying a set of trades in audience items between buyers and sellers which optimize gains obtained by buyers and sellers from the set of trades in audience items based on the bids and offers received by said trading means, and calculating a price for each audience item in the set of trades, and identifying rejected buyer bids and rejected seller offers.

Owner:SIENA HLDG

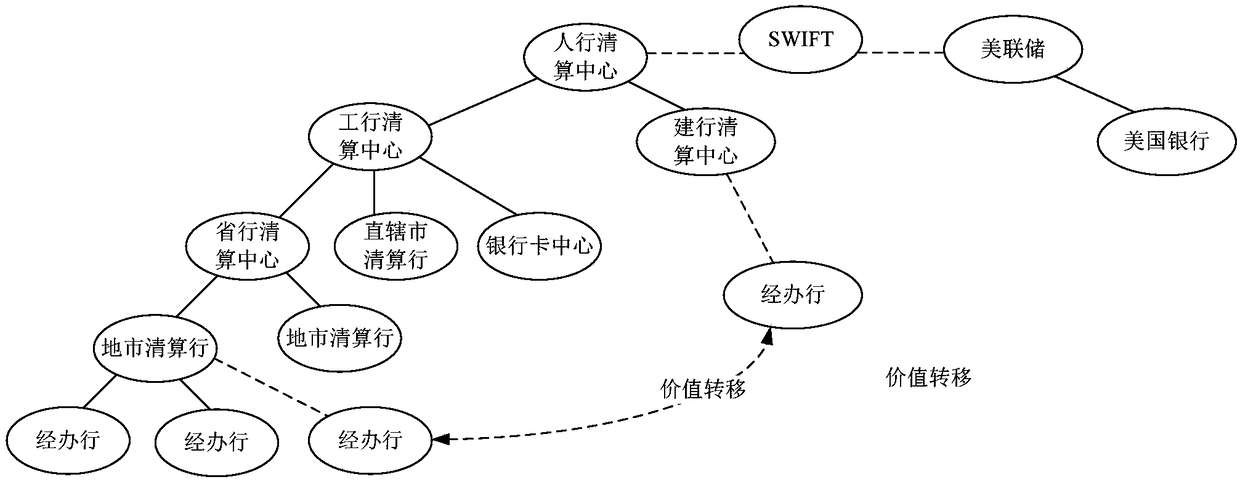

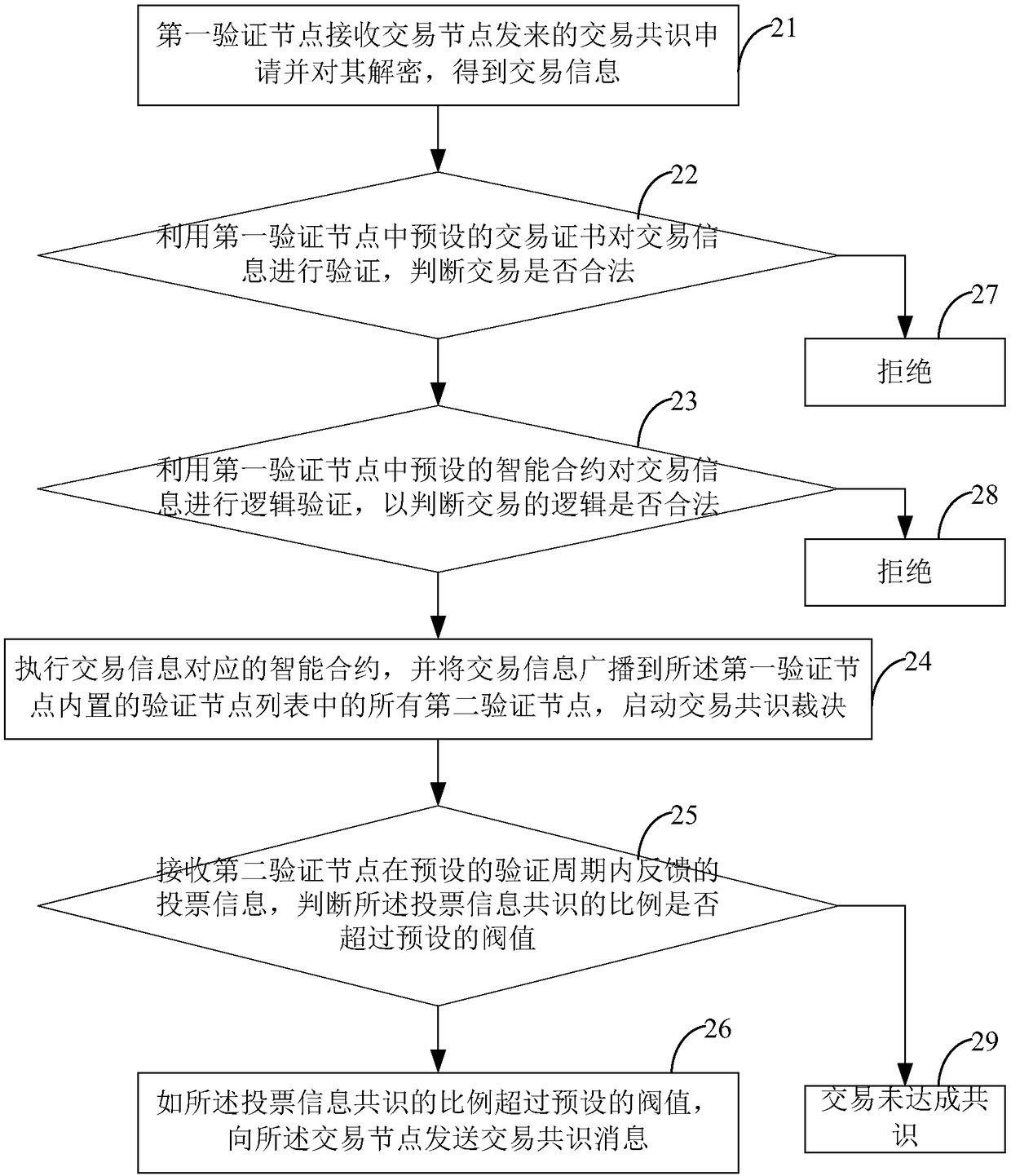

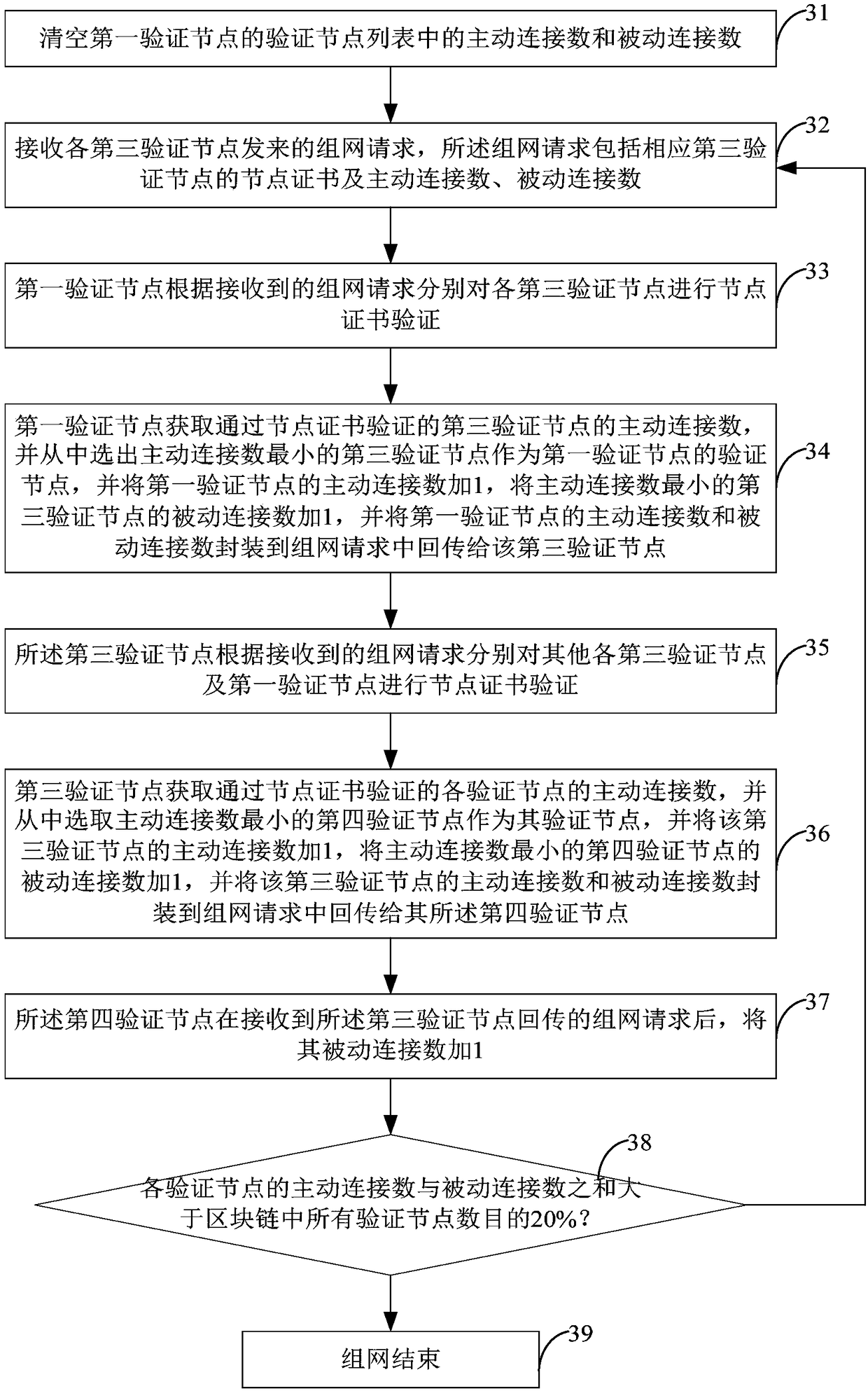

Block-chain-based financial product transaction consensus method, node and system

The invention provides a block-chain-based financial product transaction consensus method, node and system. The method comprises: a first verification node receives a transaction consensus applicationsent by a transaction node and decrypts the transaction consensus application to obtain transaction information; the transaction certificate is verified by using a transaction certificate preset in the first verification node to determine whether transaction is legal or not; if so, the transaction information is logically verified by using a smart contract preset in the first verification node and whether the transaction logic is legal is determined; if so, the smart contract corresponding to the transaction information is executed, the transaction information is broadcasted to all second verification nodes in a built-in verification node list of the first verification node and a transaction consensus decision is initiated; voting information fed back by the second verification nodes within a preset verification cycle is received and whether the proportion of the consensus of the voting information exceeds a preset threshold is determined; and if so, a transaction consensus message issent to the transaction node.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

Financial products having demand-based, adjustable returns, and trading exchange therefor

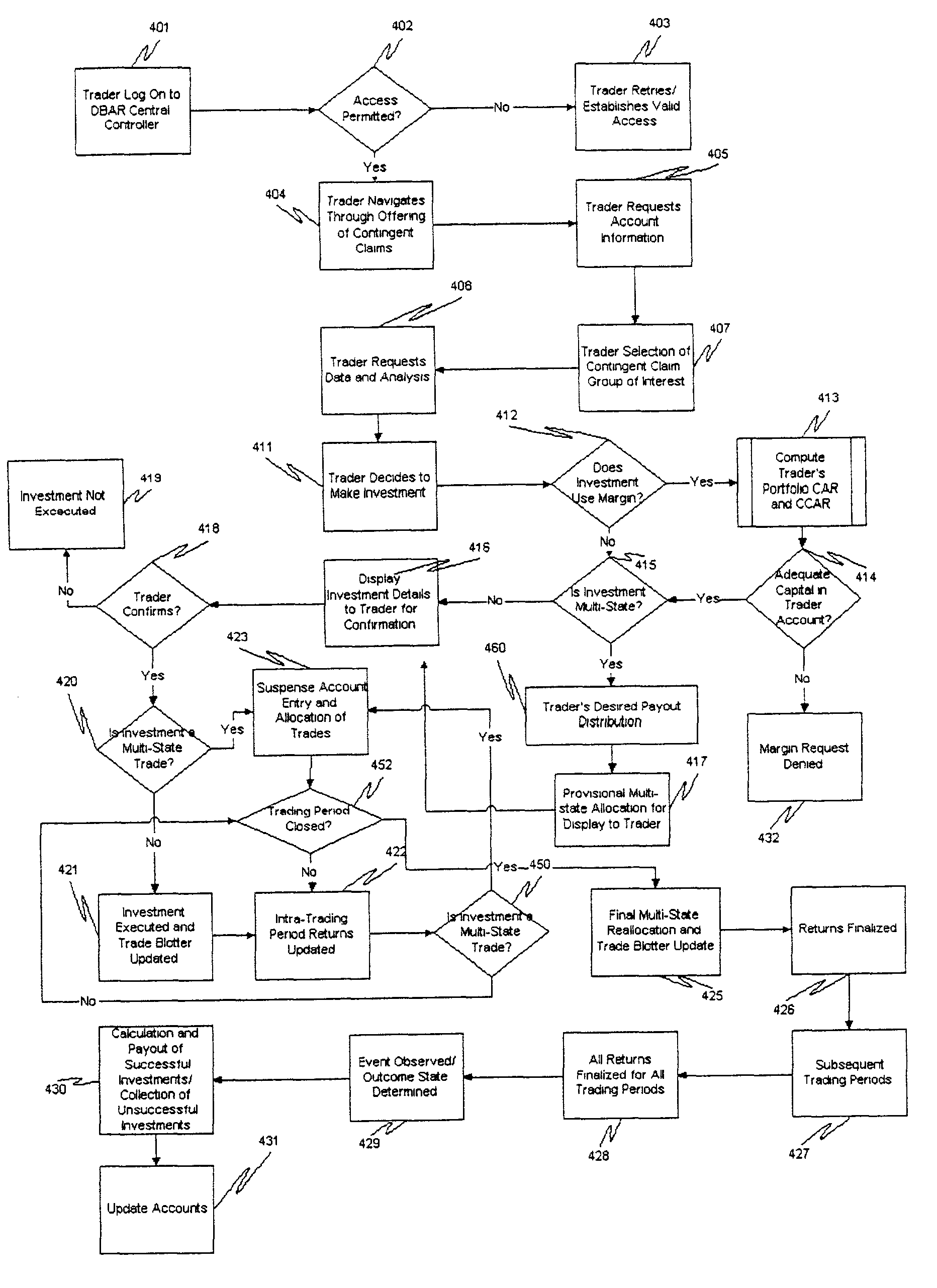

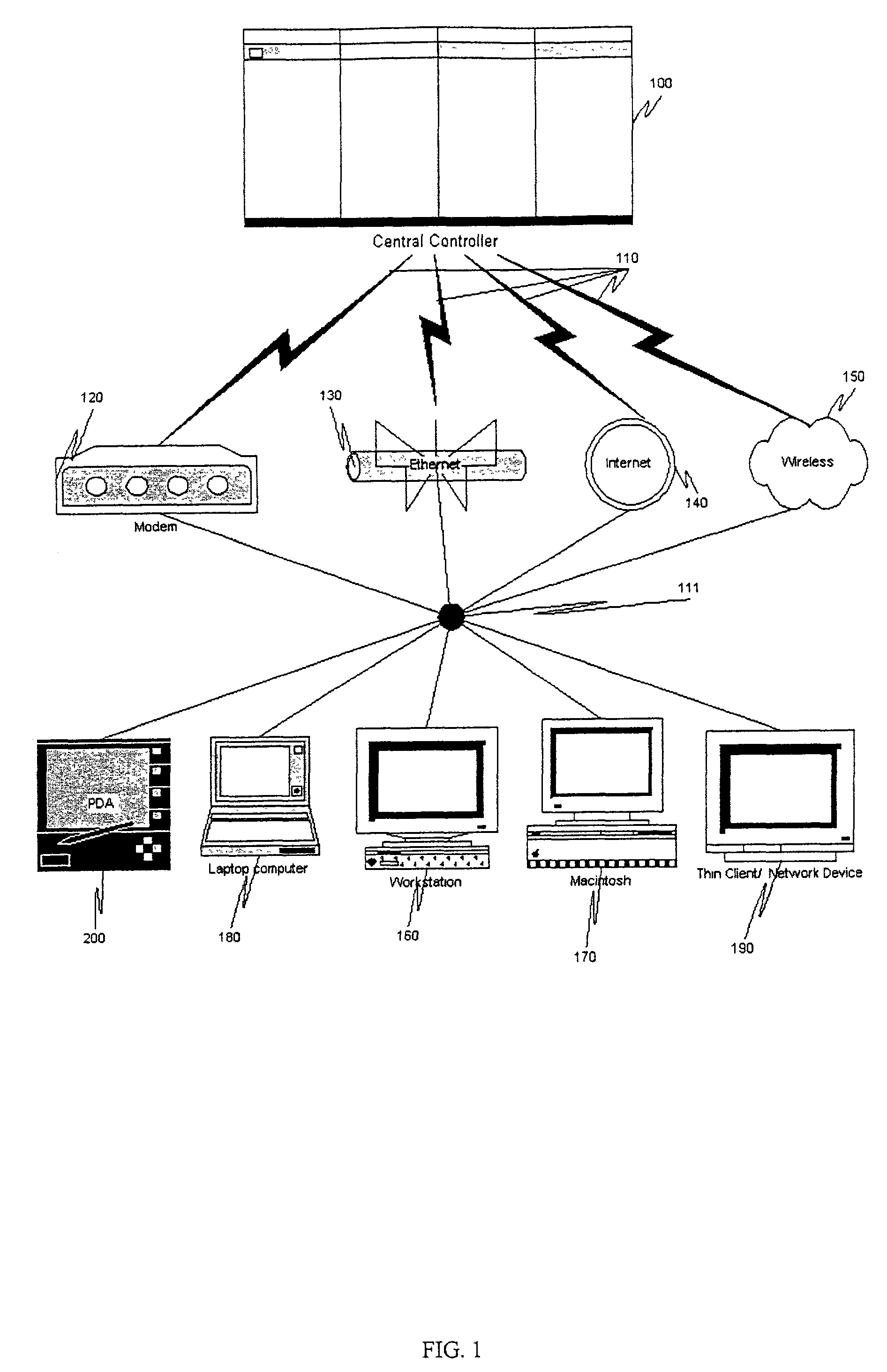

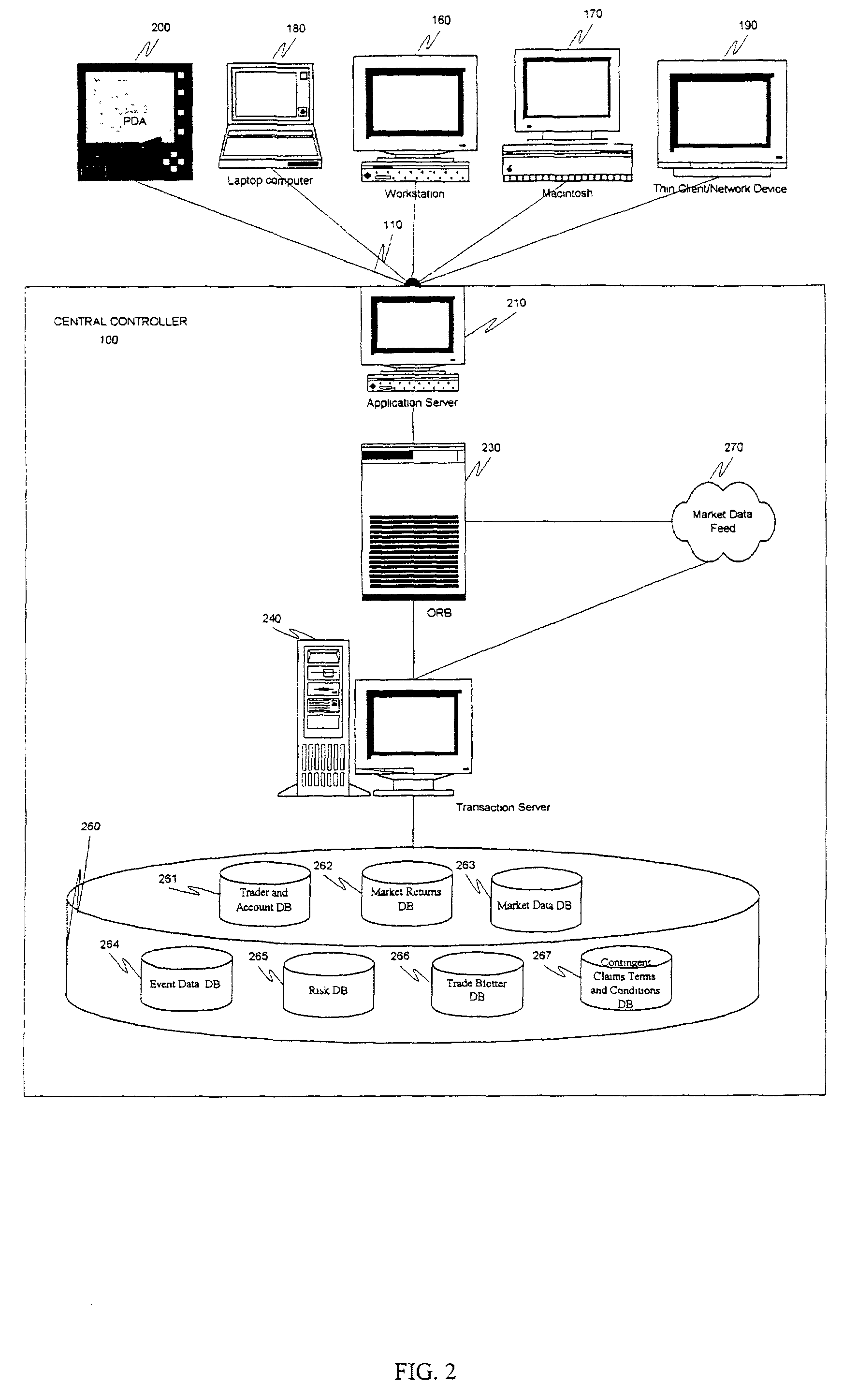

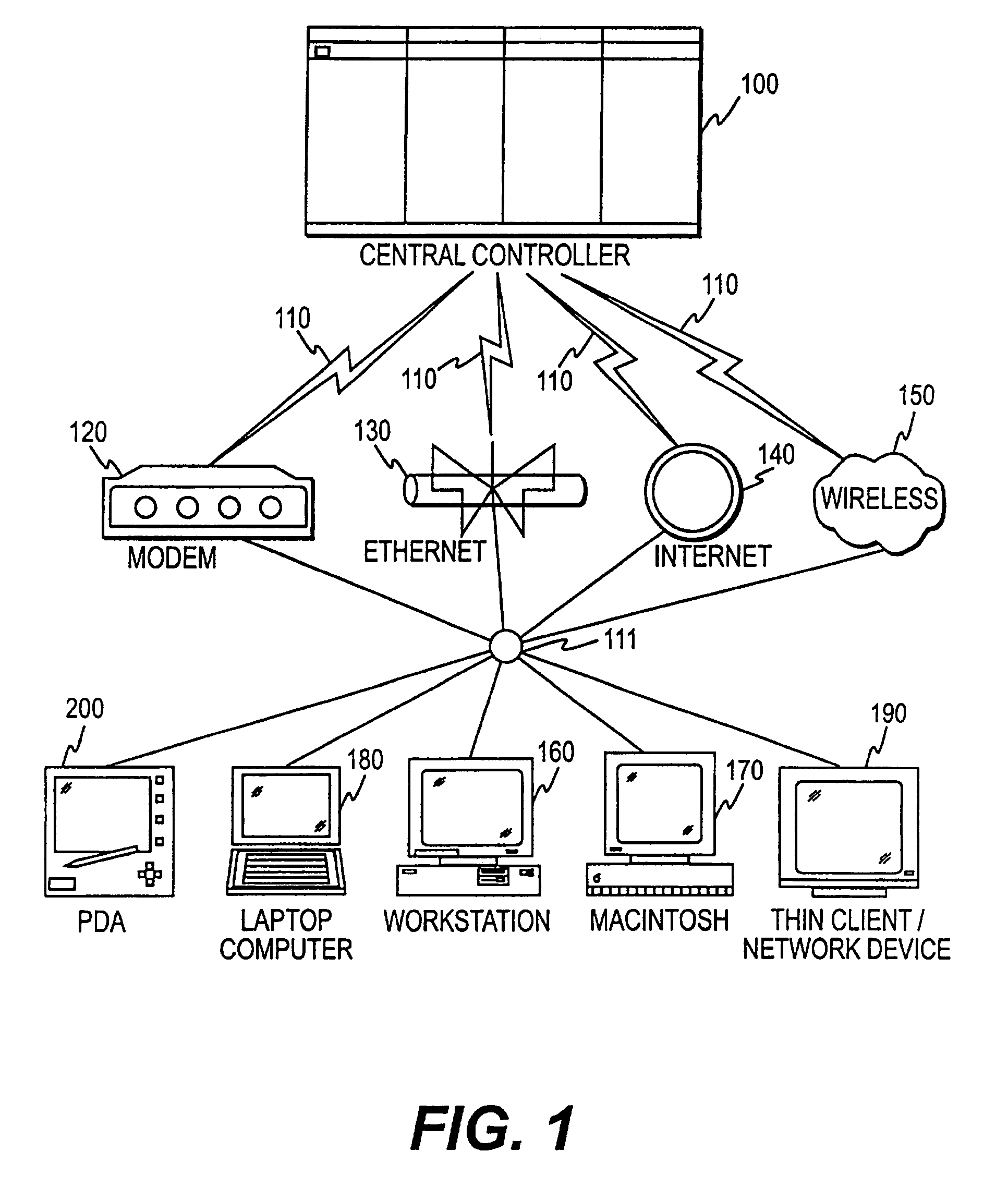

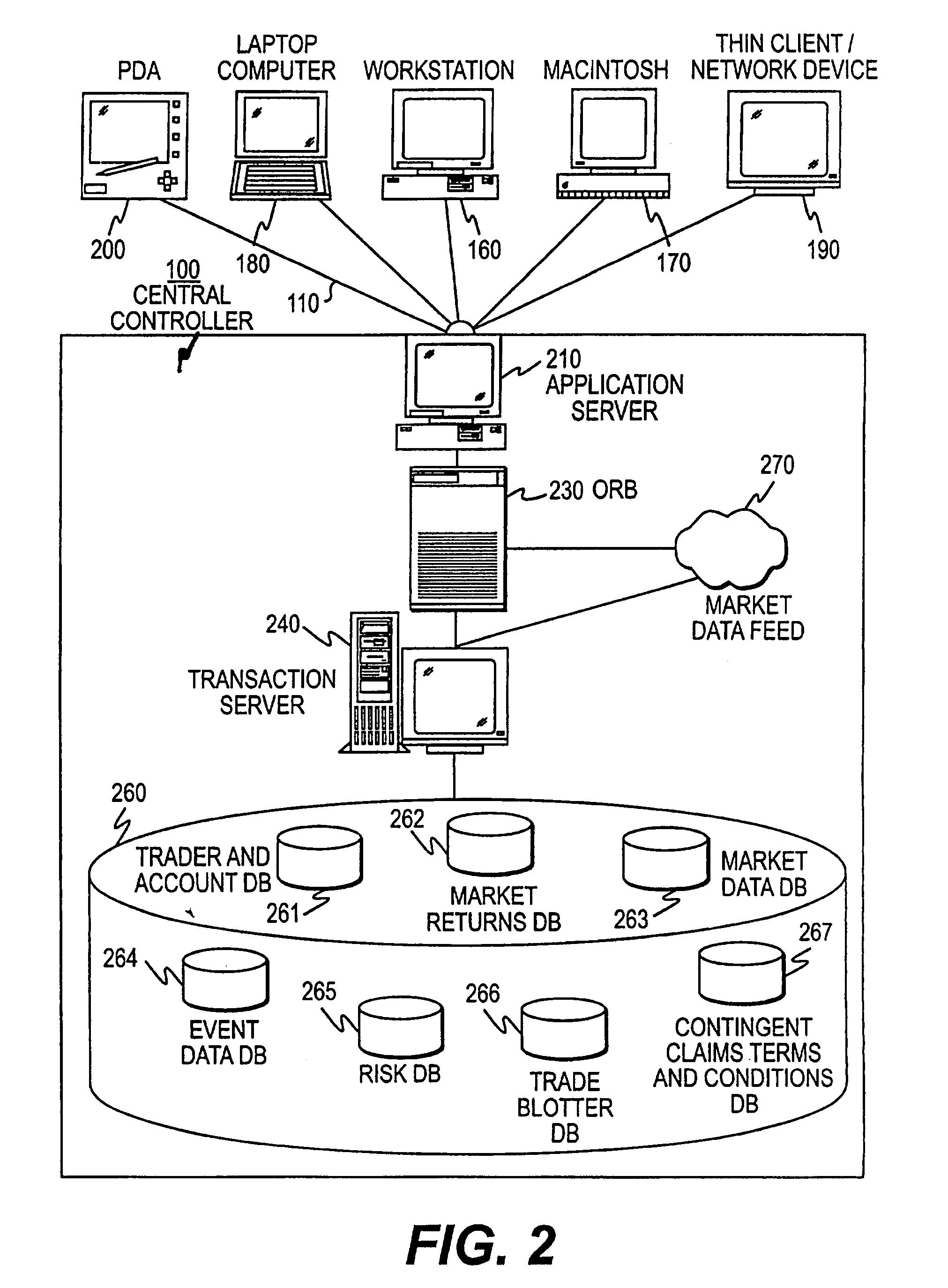

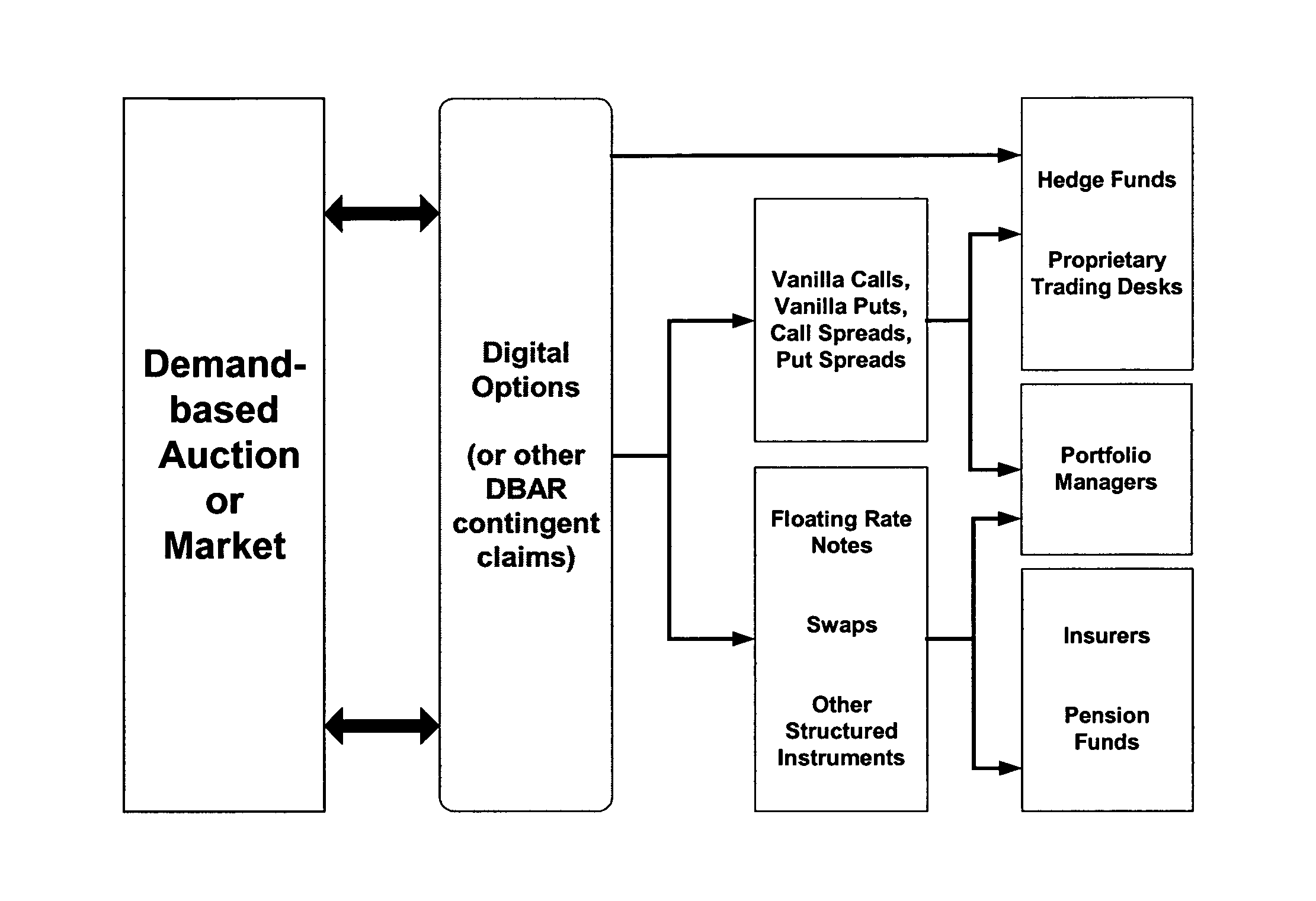

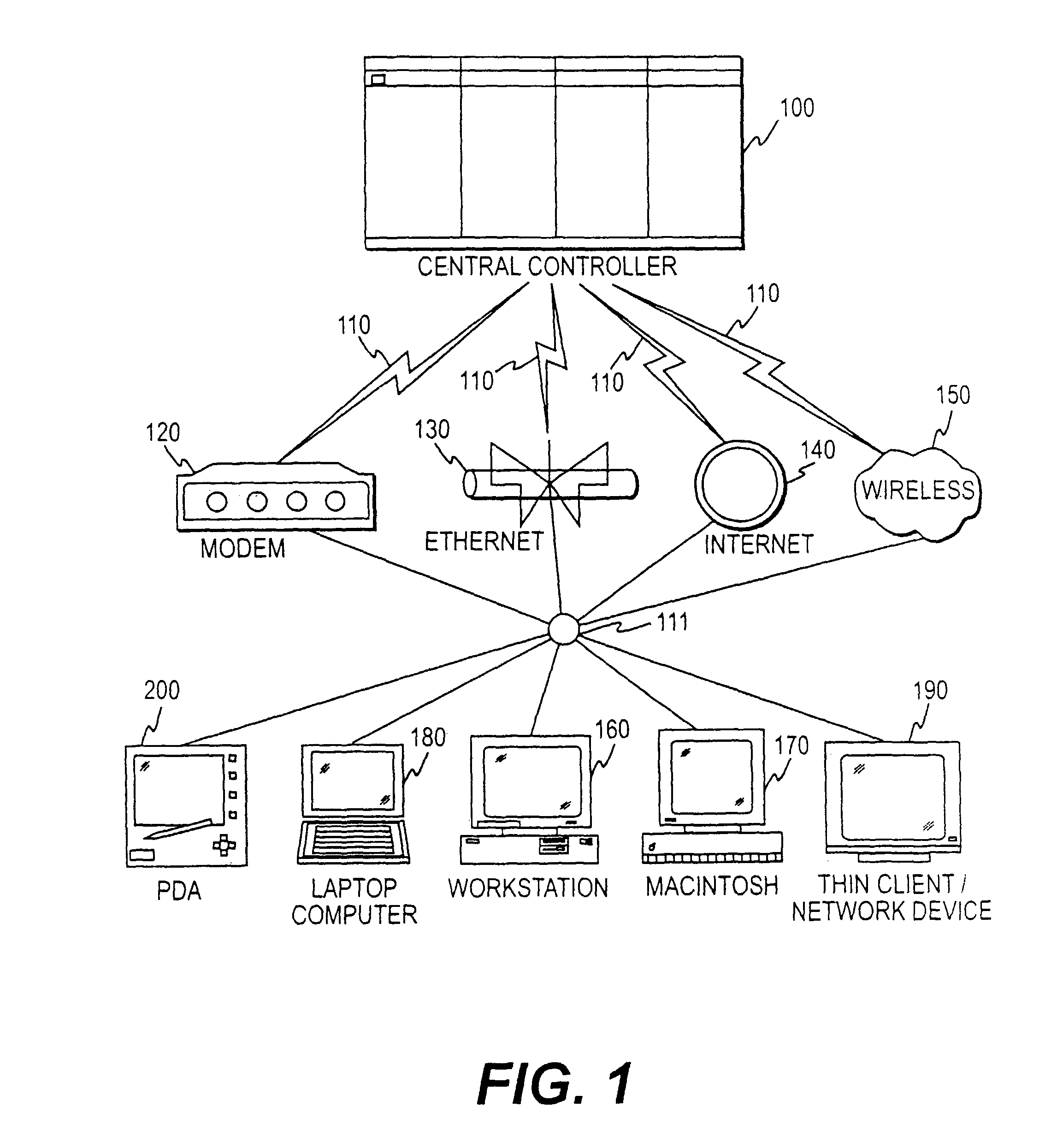

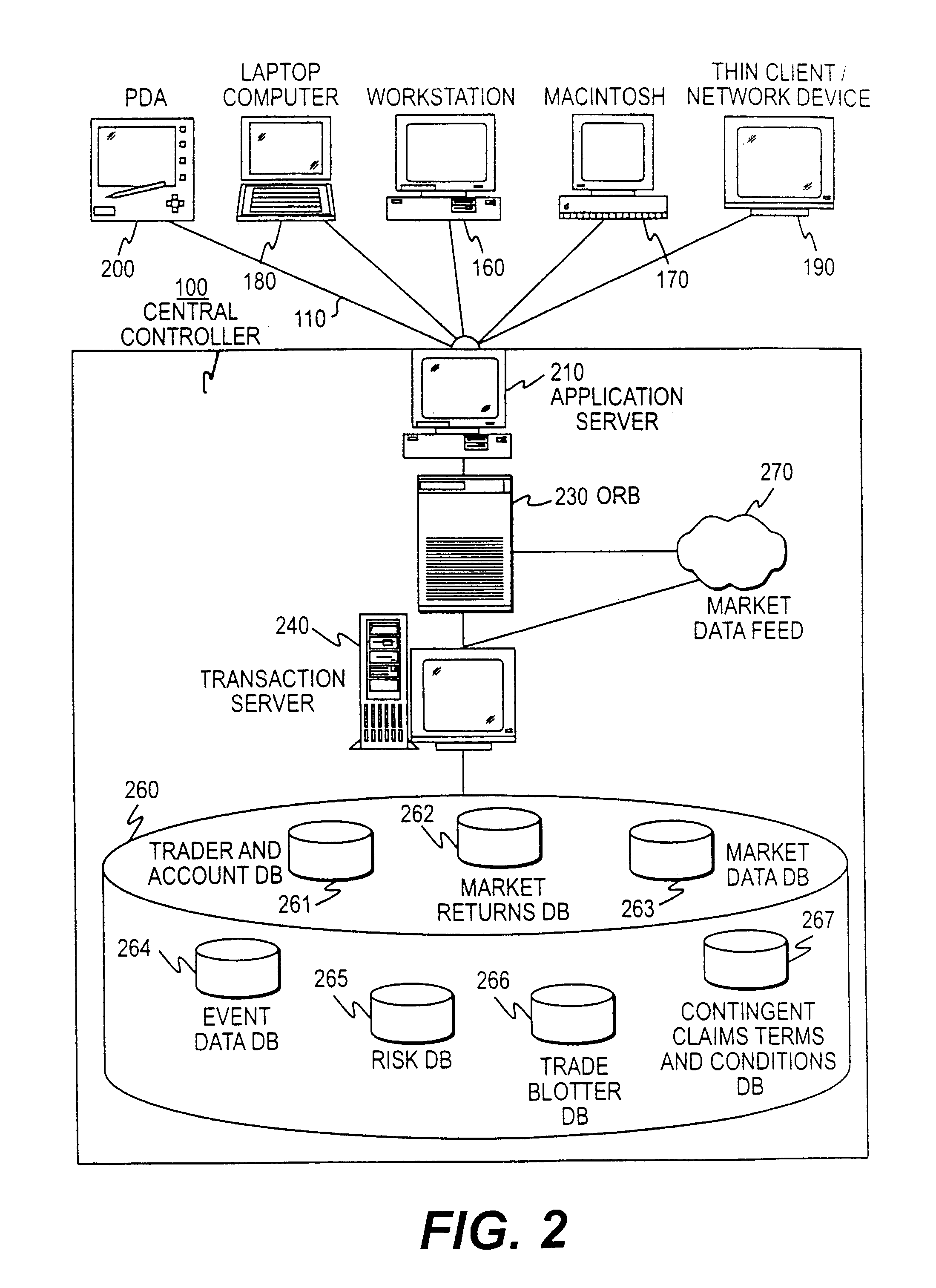

This invention provides methods and systems for trading and investing in groups of demand-based adjustable-return contingent claims, and for establishing markets and exchanges for such claims. (FIG. 2, item 262, 263, 264, 265) The advantages of the present invention, as applied to the derivative securities and similar financial markets, include increased liquidity, reduced credit risk, improved information aggregation, increased price transparency, reduced settlement or clearing costs, reduced hedging costs, reduced model risk, reduced event risk, increased liquidity incentives, improved self-consistency, reduced influence by market makers, and increased ability to generate and replicate arbitrary payout distributions. In addition to the trading of derivative securities, the present invention also facilitates the trading of other financial-related contingent claims; non-financial-related contingent claims such as energy, commodity, and weather derivatives; traditional insurance and reinsurance contracts; and contingent claims relating to events which have generally not been readily insurable or hedgeable such as corporate earnings announcements, future semiconductor demand, and changes in technology.

Owner:LONGITUDE LLC

Replicated derivatives having demand-based, adjustable returns, and trading exchange therefor

ActiveUS8126794B2Reduce transaction costsFinanceDigital data processing detailsFinancial transactionComputer science

Methods and systems for trading and replicating contingent claims, such as derivatives strategies, in a demand-based auction are described. In one embodiment, a set of demand-based claims, each of which can be a vanilla option or a digital option, approximate or replicate the contingent claim into a vanilla replicating basis or a digital replicating basis, and the order for the contingent claim is then evaluated or processed in the demand-based auction. In another embodiment, a plurality of strikes and a plurality of replicating claims are established for a demand-based auction on an event, one or more replicating claims striking at each of the strikes in the auction. A contingent claim, such as a derivatives strategy, is replicated with a replication set that includes one or more of the replicating claims in the auction. The equilibrium price and / or the payout for the derivatives strategy is determined as a function of the demand-based valuation of each of the replicating claims in the replication set. For a customer order requesting a number of a certain derivatives strategy in the demand-based auction and a limit price per derivatives strategy, the premium of the customer order is determined as a product of the equilibrium price for the derivatives strategy and a filled number of derivatives strategies for the order, each determined as a function of the demand-based valuation of each of the replicating claims in the demand-based auction.

Owner:LONGITUDE LLC

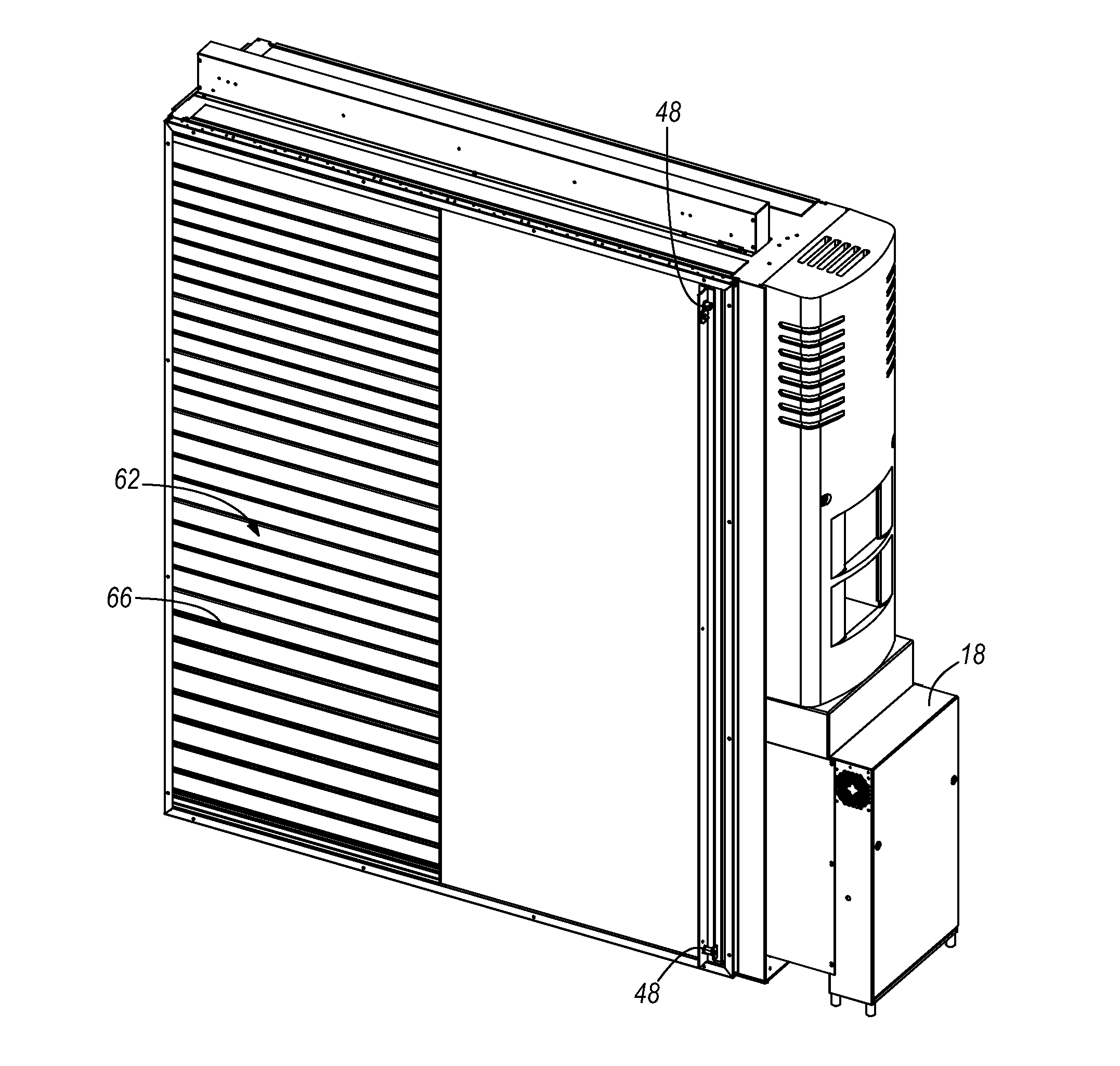

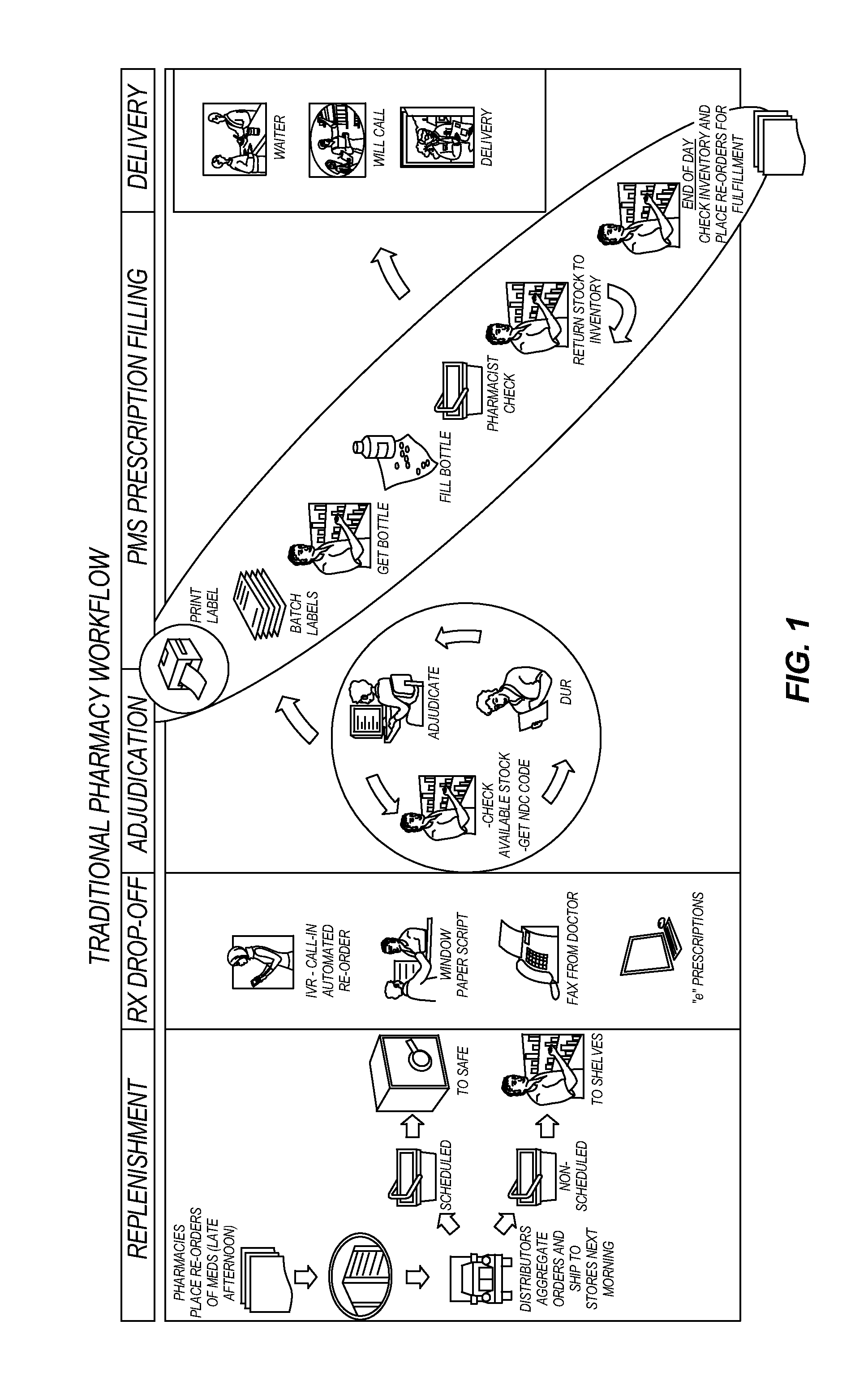

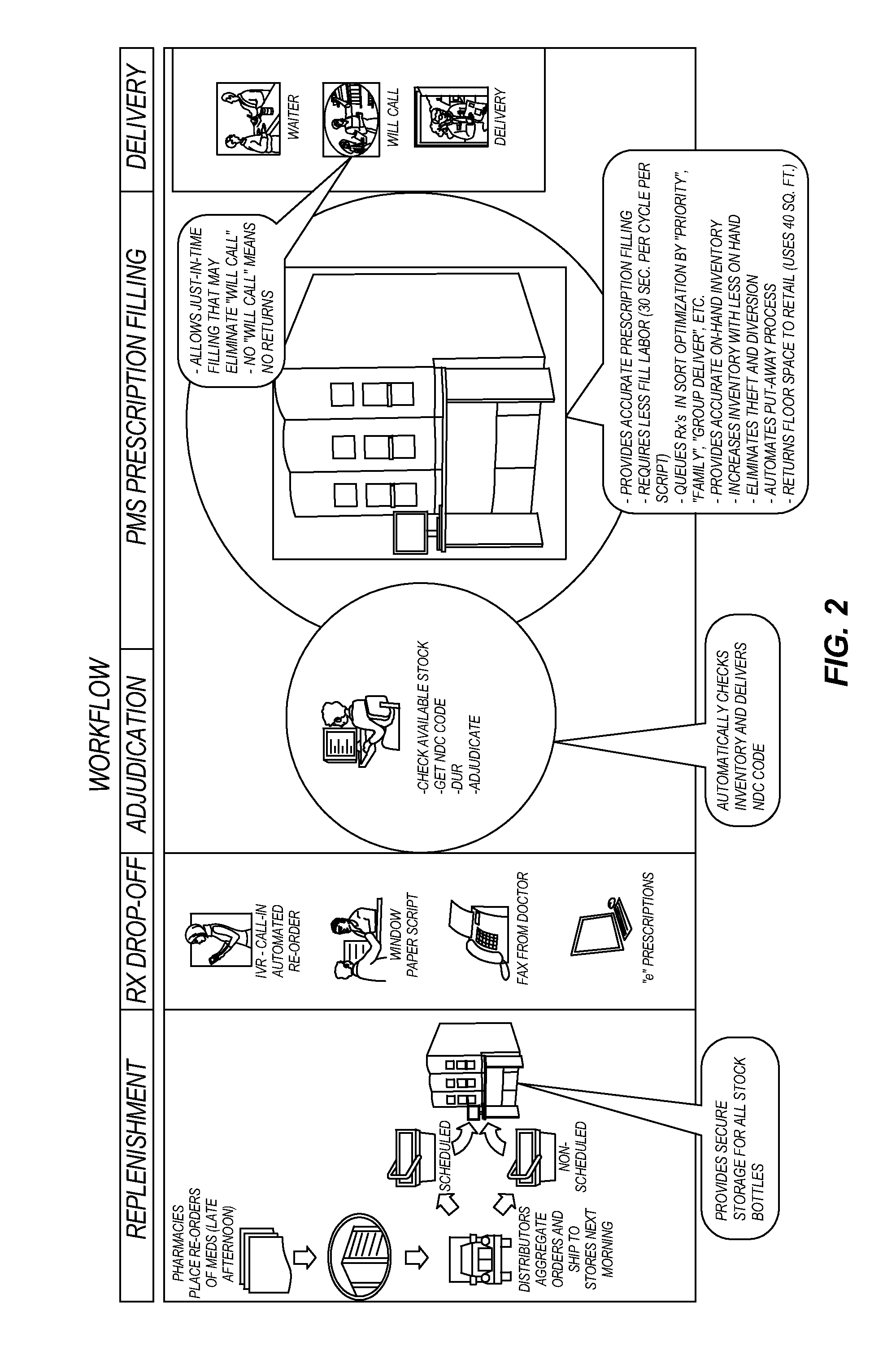

Pharmaceutical storage and retrieval system and methods of storing and retrieving pharmaceuticals

ActiveUS20110054668A1Reduce transaction costsEasy to controlSmall article dispensingDigital data processing detailsDrug productAuthorization

A pharmaceutical storage and retrieval system and a method of storing and retrieving pharmaceutical containers from the system. The system includes a pharmaceutical storage and retrieval and a controller operatively coupled to the device to control storage and retrieval functions of the device. The device includes a gantry assembly, a shelving assembly, a user access assembly, and a user authorization system that function in a coordinated manner to carry out the storage and retrieval functions of the device.

Owner:RXSAFE

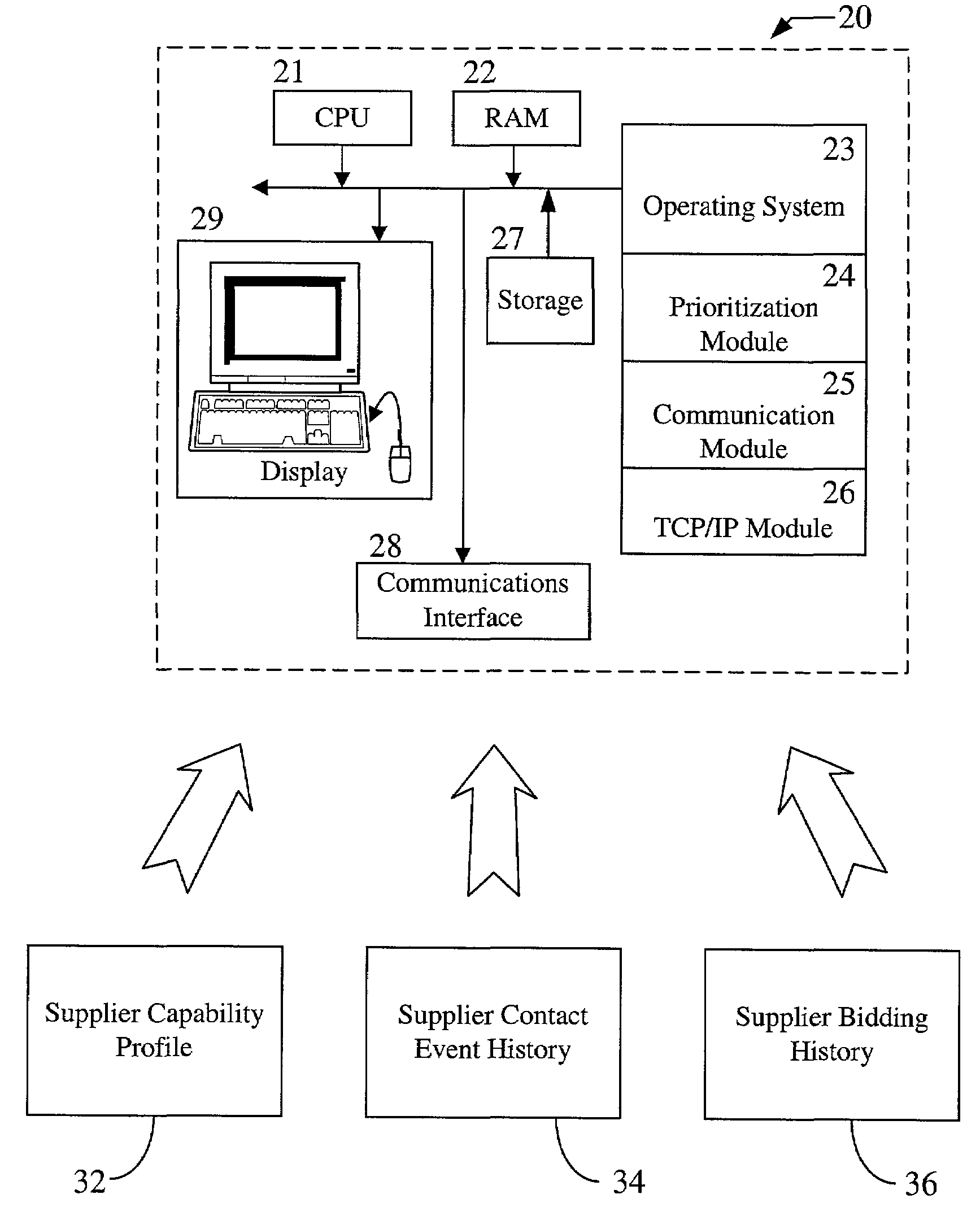

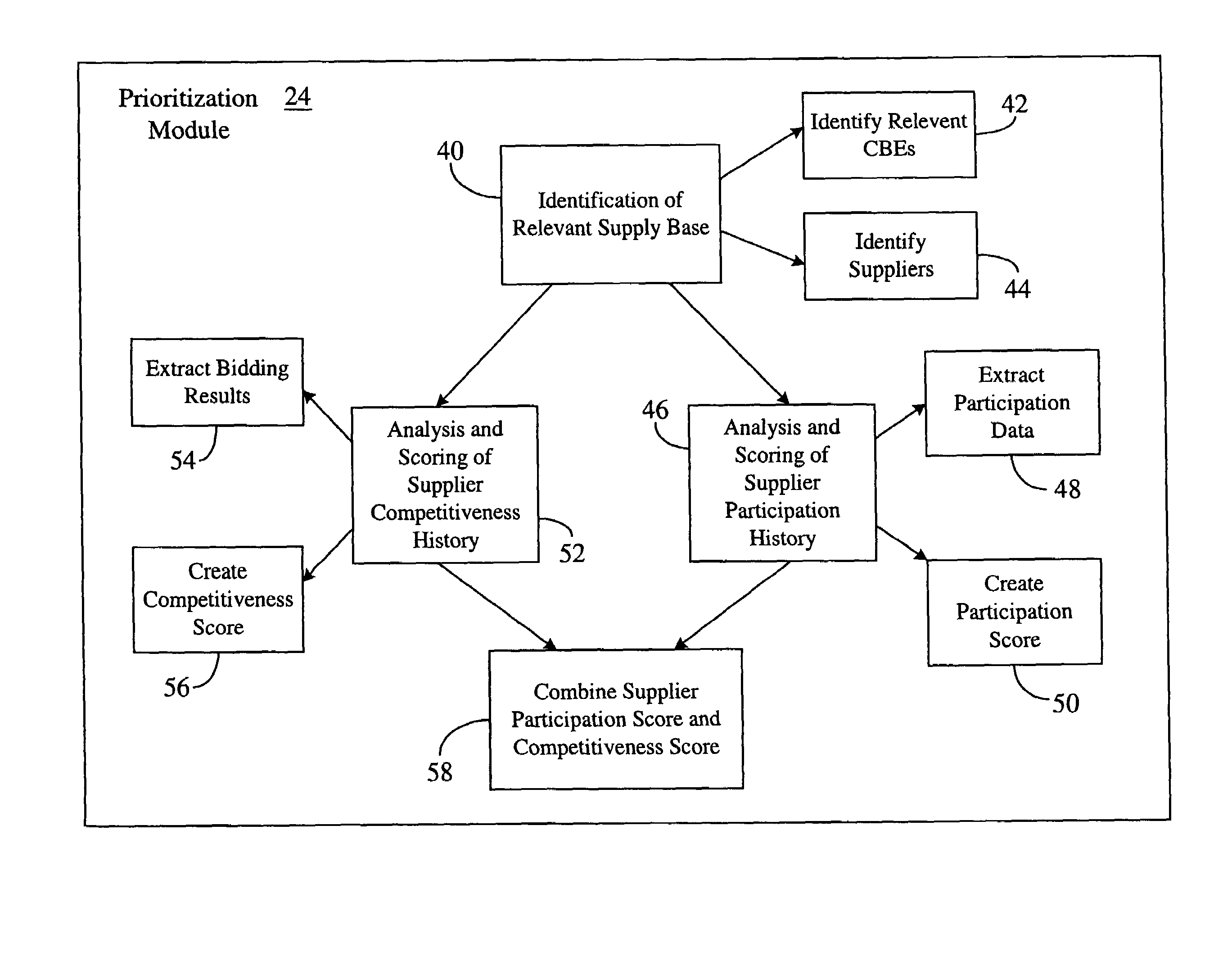

Method and system for supplier prioritization

ActiveUS7146331B1Reduce transaction costsQuantity minimizationFinanceCommerceQuantitative modelData mining

A method and system for selecting potential bidders or suppliers for a current electronic auction by using quantitative models to create a prioritized list of potential suppliers. A prioritization software analyzes a supplier's bidding participation history and bidding competitiveness history from the bidding data collected for all prior auctions in which the supplier participated or was requested by the auction coordinator to participate. Using the prior bid data, the software generates a participation score and a competitiveness score for the supplier. The participation and competitiveness scores may be combined to generate a combined score. All potential suppliers may be prioritized based on any of these scores individually or a combination of two or more of these scores. The prioritization list generated using quantitative values instead of subjective values minimizes the amount of unnecessary calls to potential suppliers and maximizes the likelihood that a called supplier will place a competitive bid in the current auction, thereby increasing the bidding yield per supplier selected.

Owner:ARIBA INC

System for selecting and purchasing assets and maintaining an investment portfolio

The invention is in the field of using a computer to provide automated investment allocation advice, selection of investment securities, customization of the automated advice, execution of investment securities, maintenance / monitoring of investment portfolios and rebalancing of investment portfolios. A user is connected to the Internet. The user connects to the portfolio management program (PMP) host computer through the Internet. The user completes a questionnaire that the PMP uses to generate a suitable investment allocation and specific portfolio strategy recommendation. The user reviews the strategy and specific information about the strategy. The information is transmitted across the Internet to the user. The information transmitted includes historic and / or hypothetical performance, historical and / or hypothetical holdings, current securities selections of the strategy, and a description of the strategy's selection methodology. The user, after making appropriate reviews, makes a decision to purchase the instruments in that portfolio. Now the user sees a list of instruments provided by the PMP host computer. The list of stocks is ordered by the degree to which they satisfy the requirements of the strategy. The user can then make the decision whether to accept, reject, or replace any individual security in the generated list or add an individual security. For example, the user can reject a security in the strategy and ask the PMP host computer to replace it with the next security that best fits. Once the user has approved the content of the proposed portfolio, the user enters an amount that the user will invest in accordance with the strategy. The PMP will allocate the investment amount across all the securities in the strategy. The user may authorize the PMP to purchase these selections through their qualified broker. The user may monitor the performance of these instruments subsequent to purchase through the PMP. The user may receive news, alerts, and / or research related materials for these instruments through the PMP. The user may authorize the PMP to rebalance their investments periodically to an updated list of instruments matching the selected strategy. The user may select a rebalance method that optimizes the tax consequences or the strategy adherence. The user has the ability to accept, reject, or replace any individual security in the generated list or add an individual security as part of the rebalance. The user can set up automatic email notification of rebalance dates or to have the PMP vote the proxy of the shares. The owner of the PMP host computer collects a payment for this service.

Owner:NETFOLIO INC

Automated system for conditional order transactions in securities or other items in commerce

InactiveUS20060184447A1Efficiently transactReduce transaction costsFinanceThird partyCommunications system

An apparatus and method of automatically and anonymously buying and selling positions in fungible properties between subscribers. The specific embodiment described in the disclosure relates to the buying and selling of securities or contracts where the offer to purchase or sell the property may be conditioned upon factors such as the ability to purchase or sell other property or the actual purchase or sale of other property. Specifically, the system described includes methods by which the system will sort and display the information available on each order, methods by which the system will match buy and sell order and attempt to use other markets to effect the execution of transactions without violating conditions set by the subscriber, methods by which the apparatus will execute transaction and report prices to third parties such that the user is satisfied and short sales are reported as prescribed by the rules and regulations of the appropriate regulatory body governing each subscriber in the associated transaction. A communication system is described which allows subscribers to communicate anonymously for the purpose of effecting transactions in such property under such conditions.

Owner:NIEBOER ROBERT +3

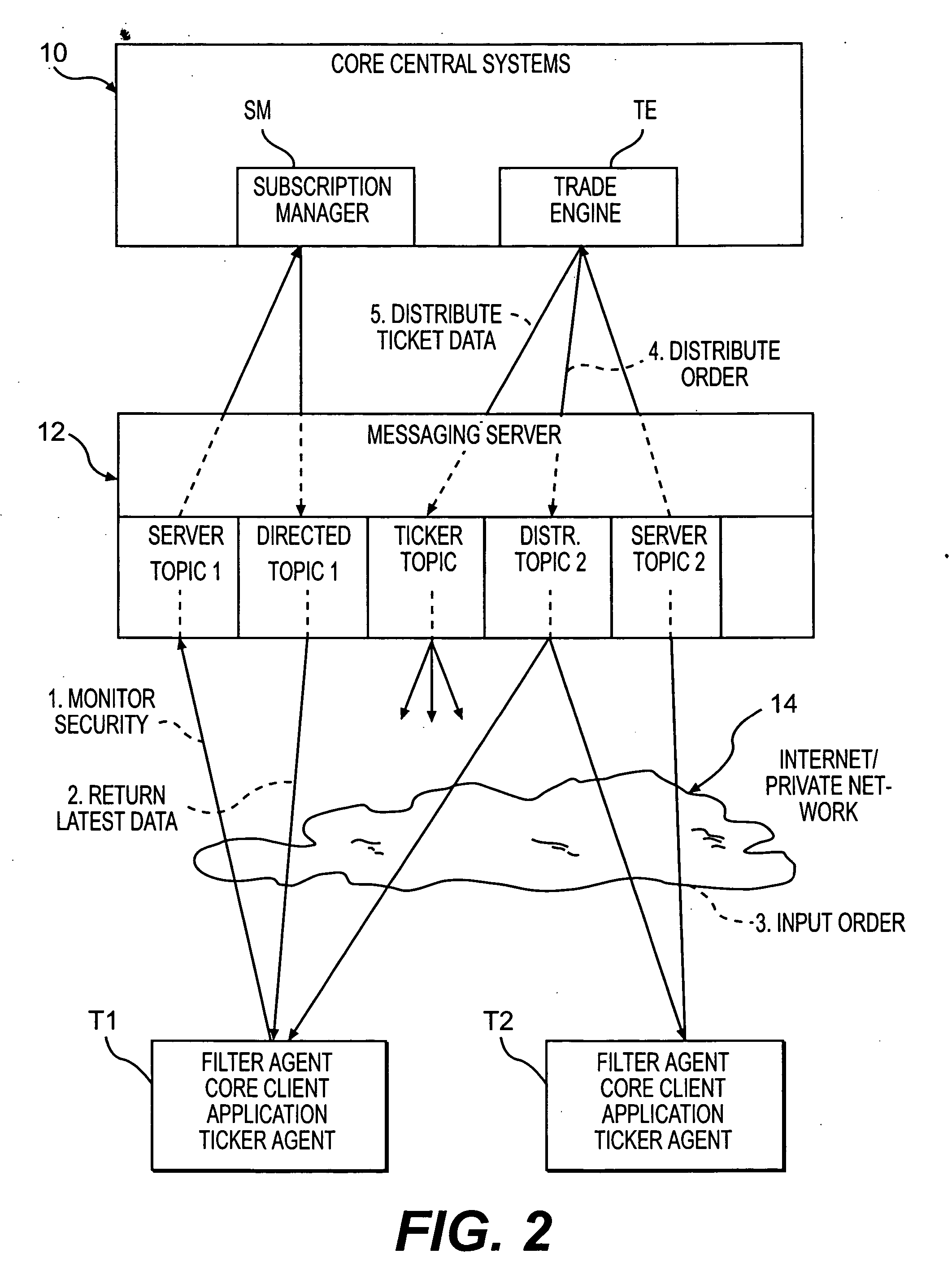

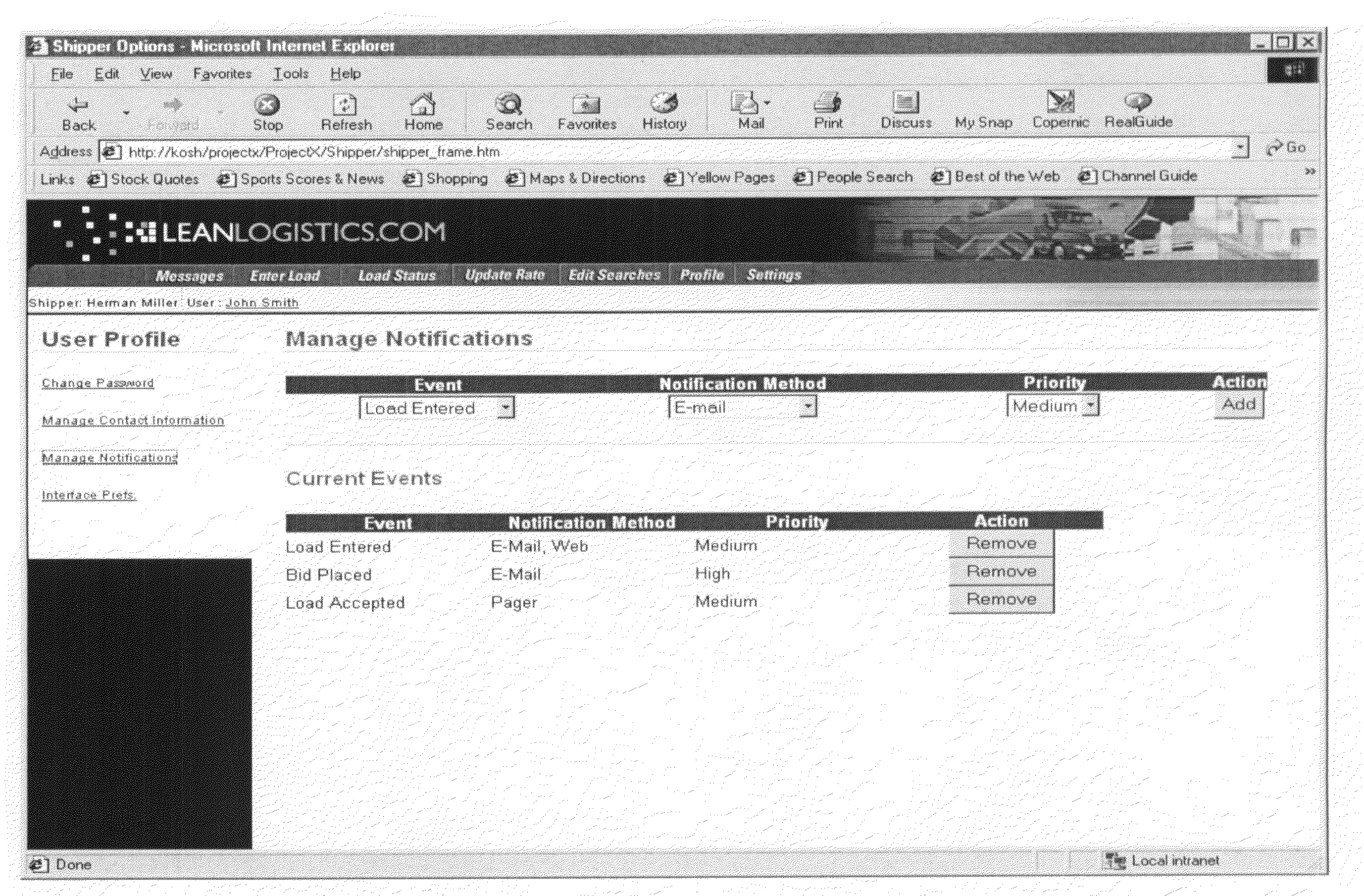

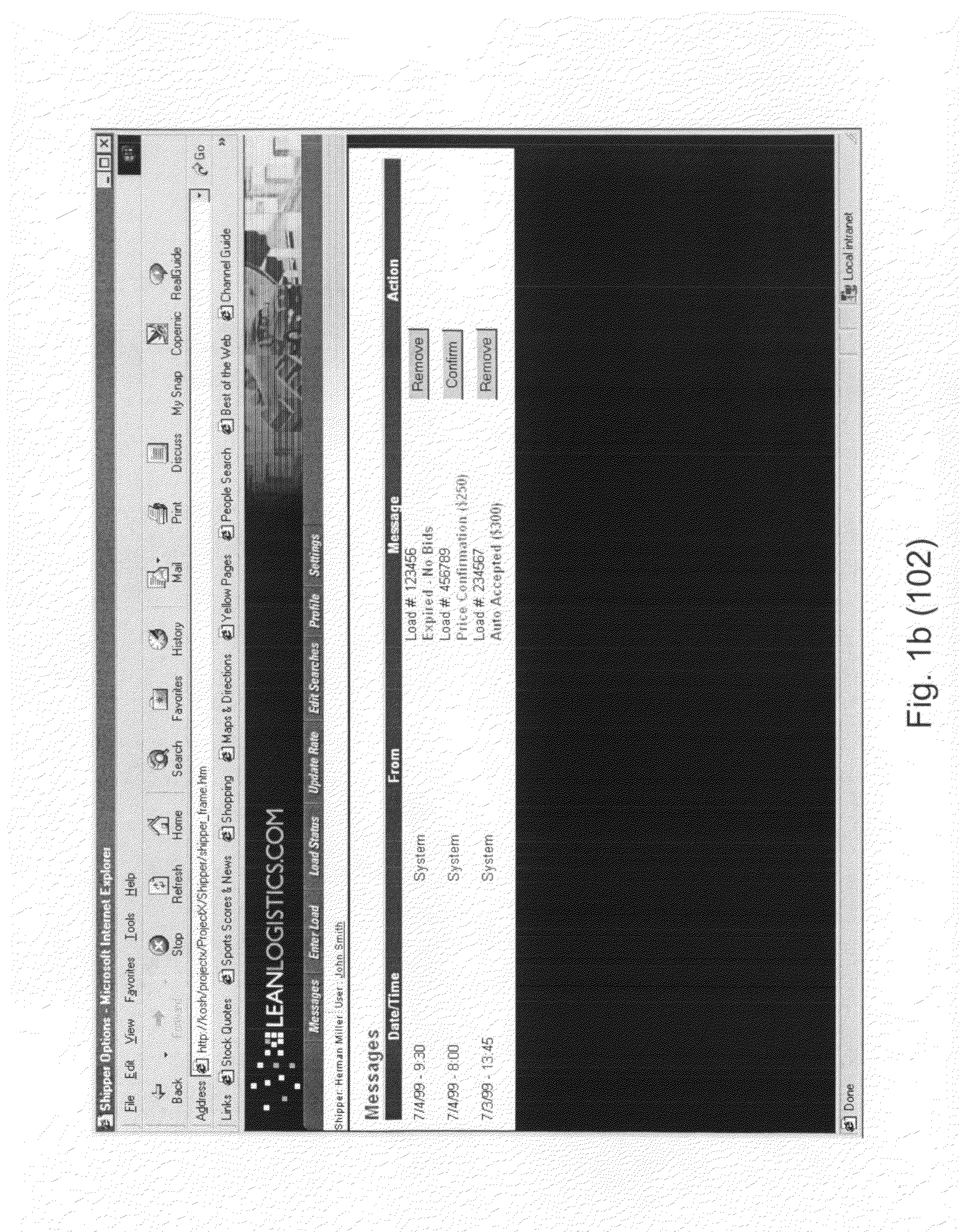

Methods and apparatus for connecting shippers and carriers in the third party logistics environment via the internet

InactiveUS20080281719A1Increase awarenessEfficient loadingFinanceBuying/selling/leasing transactionsVisibilityThird party

An online electronic marketplace in which carriers bid for loads tendered by shippers, and shippers purchase the most attractive transportation services. The system described herein efficiently matches loads and capacities, lowers transaction costs, and creates value through enhanced visibility to information resulting in efficient transportation and financial transactions. According to specific embodiments, the present invention combines a neutral marketplace patterned after a stock exchange, with the electronic format of an Internet auction site to create a trading system for the logistics industry.

Owner:LEANLOGISTICS

Personal Data Management System With Sharing Revocation

InactiveUS20140143886A1Reduce transaction costsRedundant data entryDigital data processing detailsAnalogue secracy/subscription systemsInternet privacyData management

A data vault system allows for centralized storage of personal data about a consumer associated with sharing permissions designating how that data may be shared and including an option to revoke permission of previously shared data. Data may be collected into cards describing a subset of globally stored data to be shared with individual vendors and providing separate sharing statuses for fine resolution control. Both intentionally entered personal data and data collected about the consumer may be protected in this data vault system.

Owner:SOLOMO IDENTITY

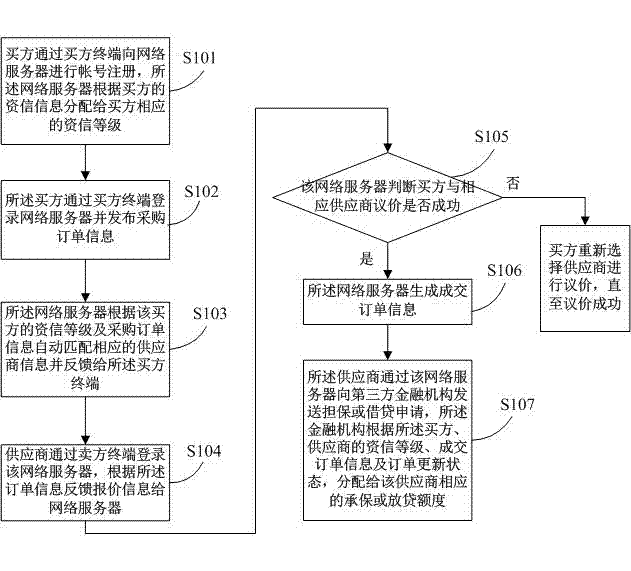

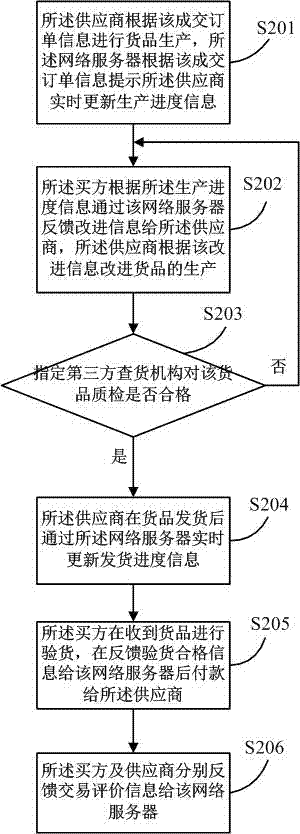

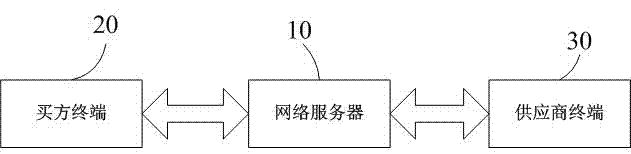

Method and system for e-commerce transactions

InactiveCN103971280AReal-time updateImplement queryBuying/selling/leasing transactionsProduction scheduleLogistics management

The invention discloses a method and a system for e-commerce transactions. The method comprises the following steps that a buyer releases purchase order information through a buyer terminal, a network server automatically matches corresponding supplier information, a matched supplier feeds back quotation information to the network server according to the order information, and the buyer bargains with the corresponding supplier according to the quotation information to generate transaction order information; the network server prompts the supplier to update production schedule information in real time; the supplier updates the production schedule information and delivery schedule information in real time through the network server, the delivery schedule information comprises commodity inspection schedule, customs clearance schedule and logistics customs clearance and dispatch schedule, and the buyer and the supplier respectively feed back transaction evaluation information to the network server. The method and the system disclosed by the invention can carry out automatic identification, matching and schedule tracking and prompting on two parties of transactions, realize real-time updating, query and feedback of the transaction status, reduce the transaction risk and cost, and improve the working efficiency and success rate of transactions.

Owner:SHENZHEN HONGHAI IMPORTS & EXPORTS

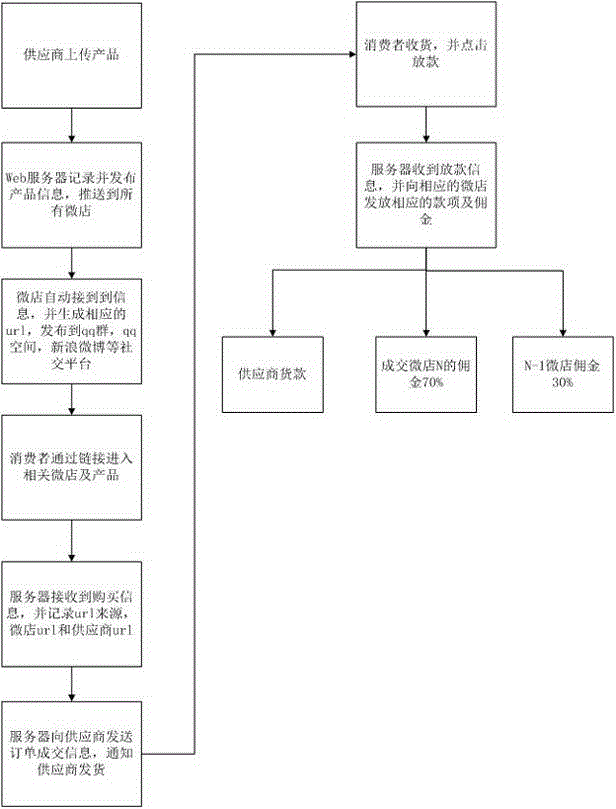

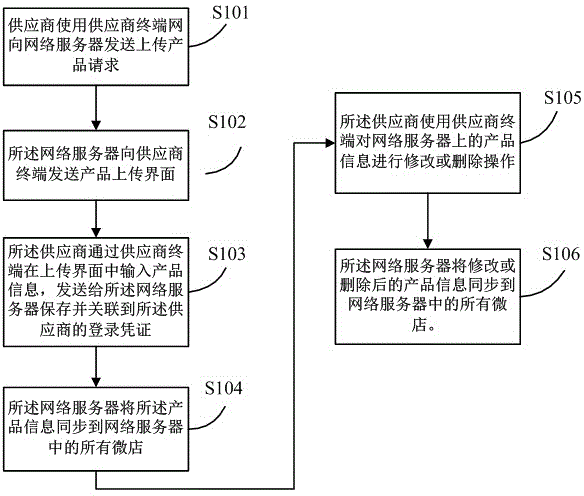

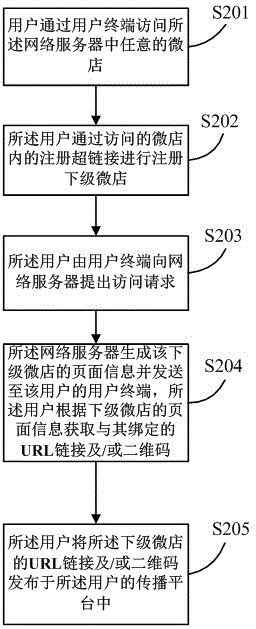

Cloud sale electronic commerce trading method and system

The invention discloses a cloud sale electronic commerce trading method and system. The method comprises the steps that: a supplier logs in a network server to publish product information through a supplier terminal network; when a consumer transfers to any micro store in the network server from a URL (Uniform Resource Locator) link and / or a two-dimensional code of the user through a consumer terminal and buys a corresponding product; the network server records user information on the product transaction micro store and the user information on a superior micro store of the micro store, and the network server generates order information and a payment page and feeds back to the consumer terminal and the supplier terminal; the network server pays the payment to the suppliers in a set period respectively after the consumer confirms receipt, and pays the commission to the user of the product transaction micro store and the user of the superior micro store of the micro store according to a preset proportion. According to the method and the system, the product promotion cost and the transaction risk and cost of the supplier enterprise are reduced, and the working efficiency and the success rate of transaction are improved.

Owner:深圳市云商微店网络技术有限公司

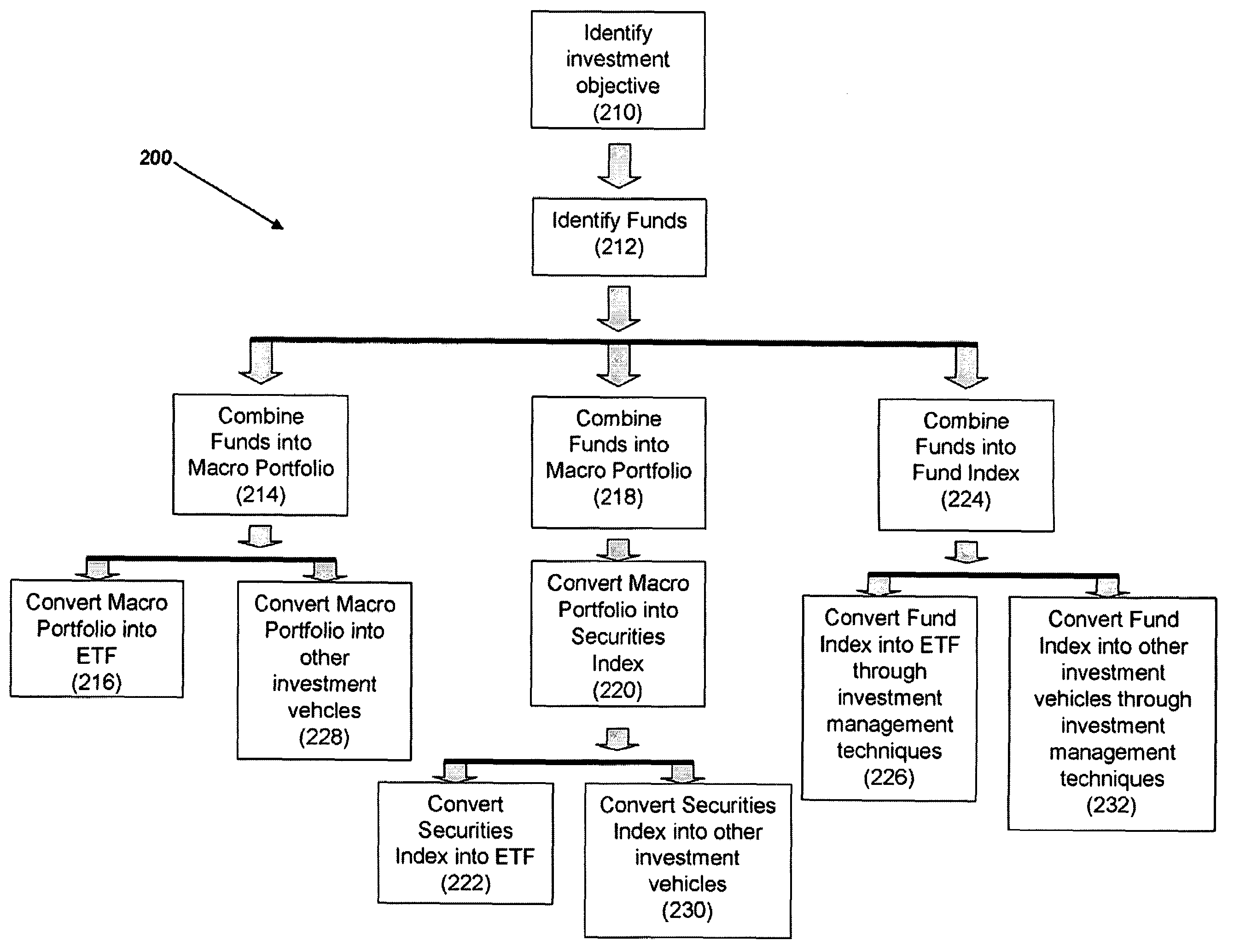

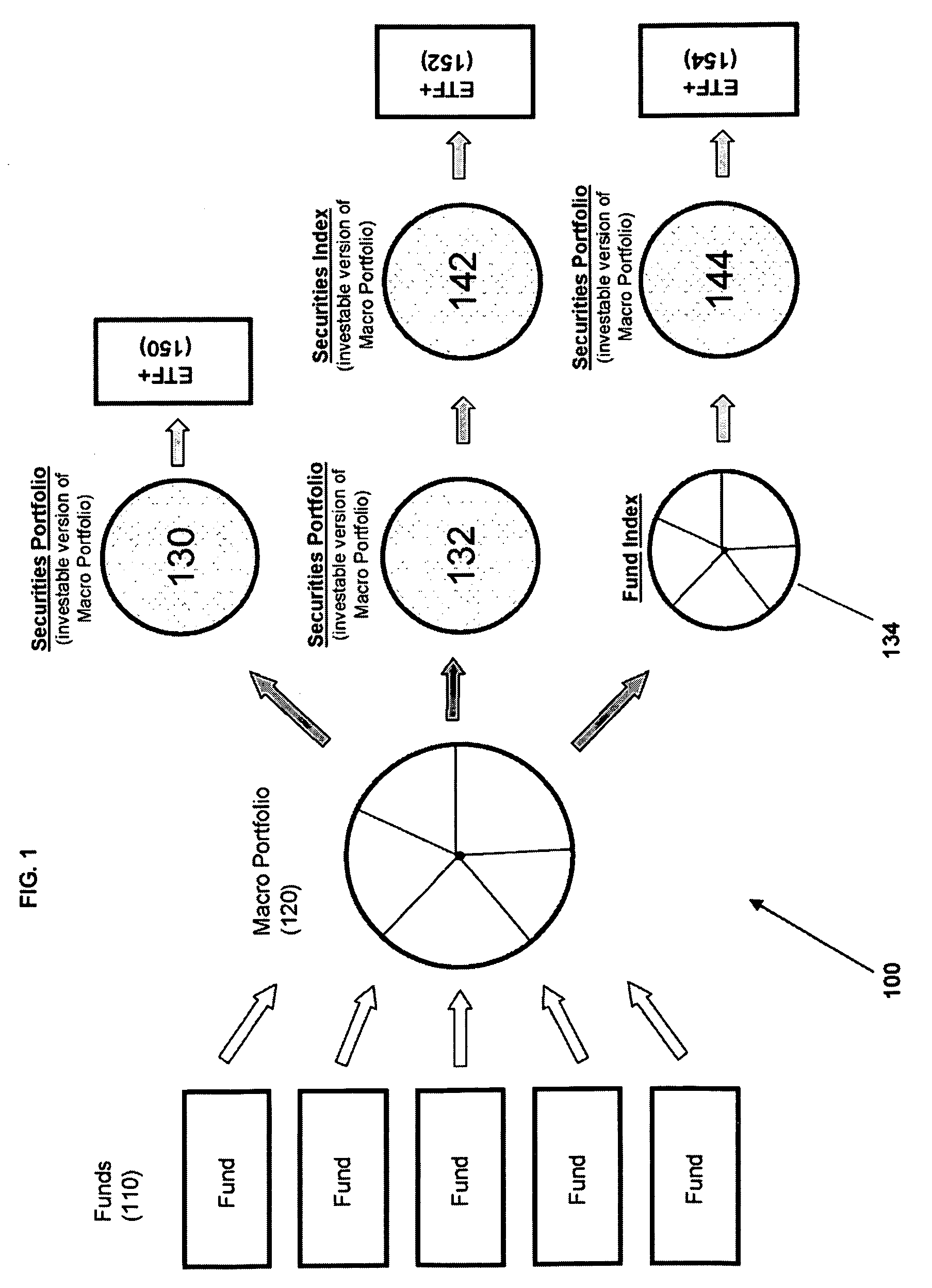

Systems and methods for constructing exchange traded funds and other investment vehicles

A method of forming an exchange traded fund (ETF) can include the steps of identifying an investor investment need, identifying funds that can be combined together to meet the investment goal, combining the identified funds to form a macro portfolio and converting the macro portfolio into an ETF. The step of converting the macro portfolio into an ETF can include one or more of generating a set of securities that, when combined, create a portfolio that tracks the performance of the macro portfolio, and constricting an index that is designed to track the performance of the macro portfolio. Other investment vehicles can be formed.

Owner:F SQUARED INVESTMENTS

Method for selecting a group of bidders for a current bidding event using prioritization

InactiveUS7401035B1Reduce transaction costsQuantity minimizationFinanceCommerceQuantitative modelData mining

Owner:ARIBA INC

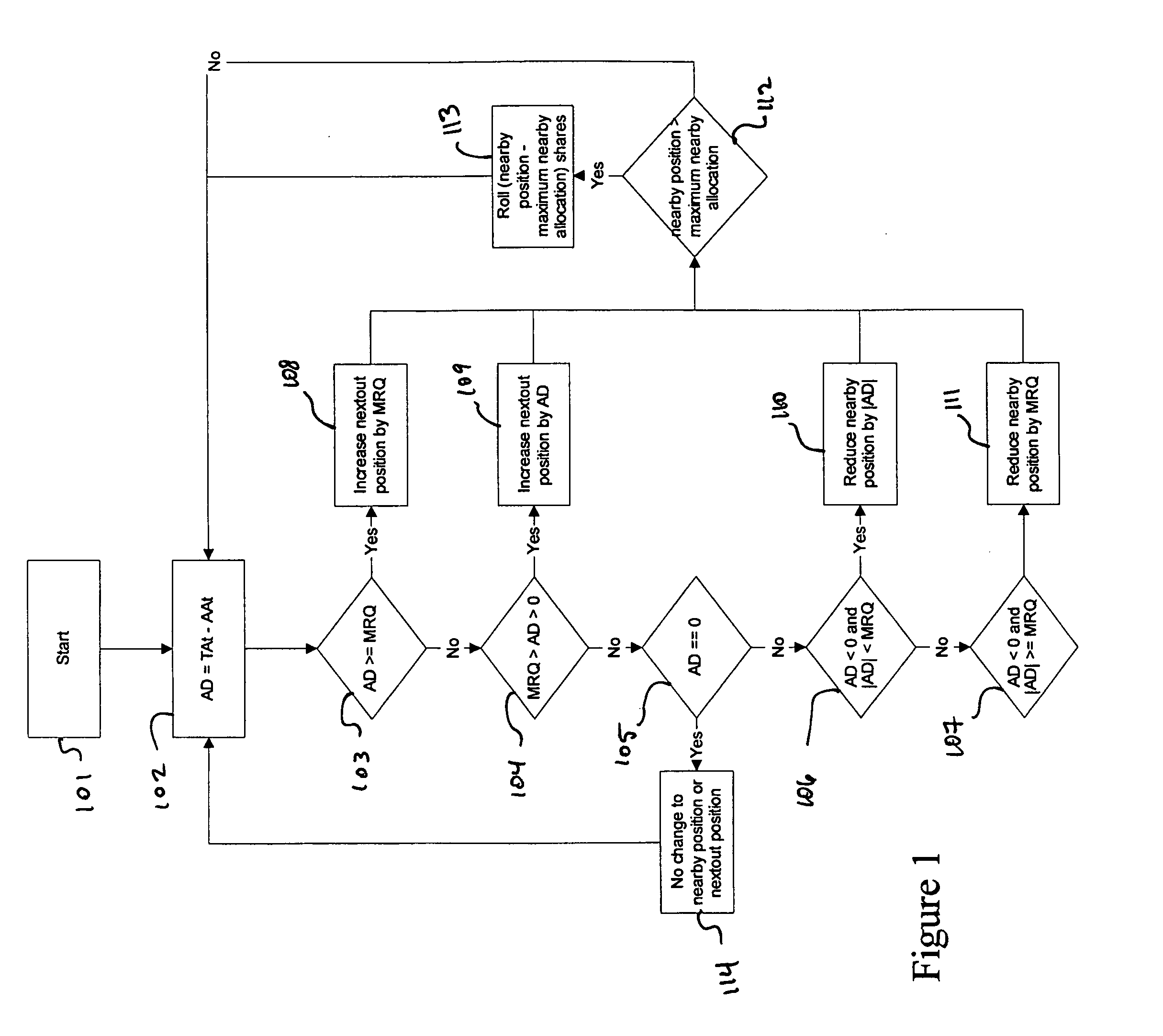

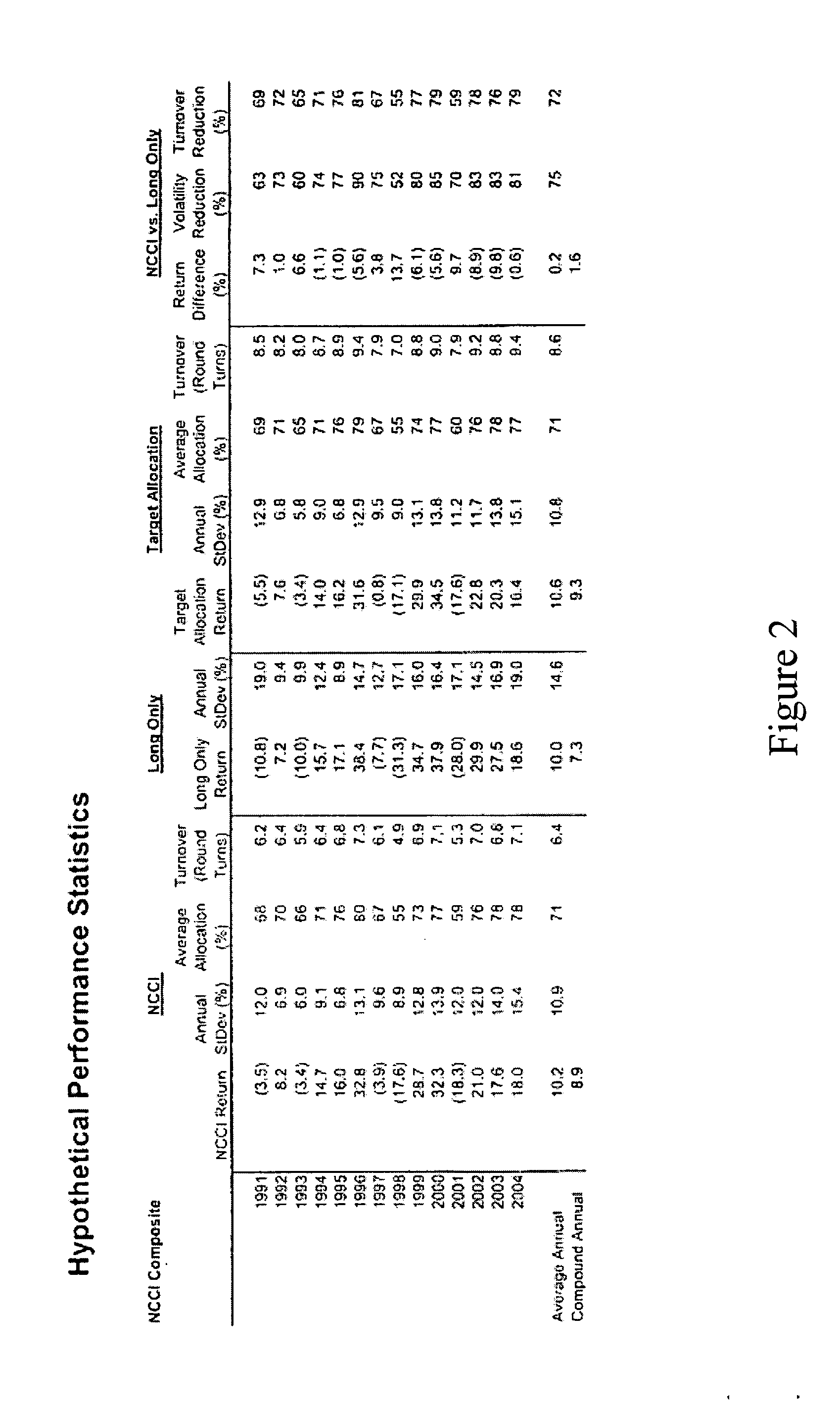

Commodity futures index and methods and systems of trading in futures contracts that minimize turnover and transactions costs

This invention relates to methods and systems for reducing transaction costs and minimizes turnover in the trading of futures contracts. The invention further describes an algorithm whose output is a unique method of investing in futures contracts that reduces the rate of turnover, and thus the cost of trading, of certain common trading strategies. The primary application of this method is to a class of strategies referred to as indexing strategies that incorporate a dynamic asset allocation approach using futures contracts.

Owner:PFDS HLDG

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com