Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

237results about How to "High return" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Return-driven casino game outcome generator

ActiveUS20090061999A1Positively affect their destinyHigh returnApparatus for meter-controlled dispensingVideo gamesReflexSkill sets

The Return Driven Casino Game Outcome Generator makes the first true class of casino video game possible by creating games that measure and reward skills like fast reflexes and manual dexterity while earning consistent and reliable profits for game operators. An embodiment of a method incorporating RDOG may include steps of requiring a player to purchase a predetermined amount of playing time for a predetermined amount of money; inputting an initial average Return-To-Player (RTP) percentage of the regulated game; initiating the regulated game, and during the purchased predetermined amount of playing time: providing a plurality of reward generating assets and enabling the player to interact therewith, a successful interaction with a reward generating asset generating a reward for the player, and providing a plurality of time penalty inducing assets, interaction with one of which imposes a predetermined time penalty during which the player is prevented from interacting with any of the plurality of reward generating assets whereby, after interaction with one of the plurality of penalty inducing assets, the initial average RTP percentage is reduced by an amount proportional to a length of the predetermined time penalty.

Owner:IGT

Return-driven casino game outcome generator

ActiveUS20090061998A1Positively affect their destinyHigh returnApparatus for meter-controlled dispensingVideo gamesReflexGraphics

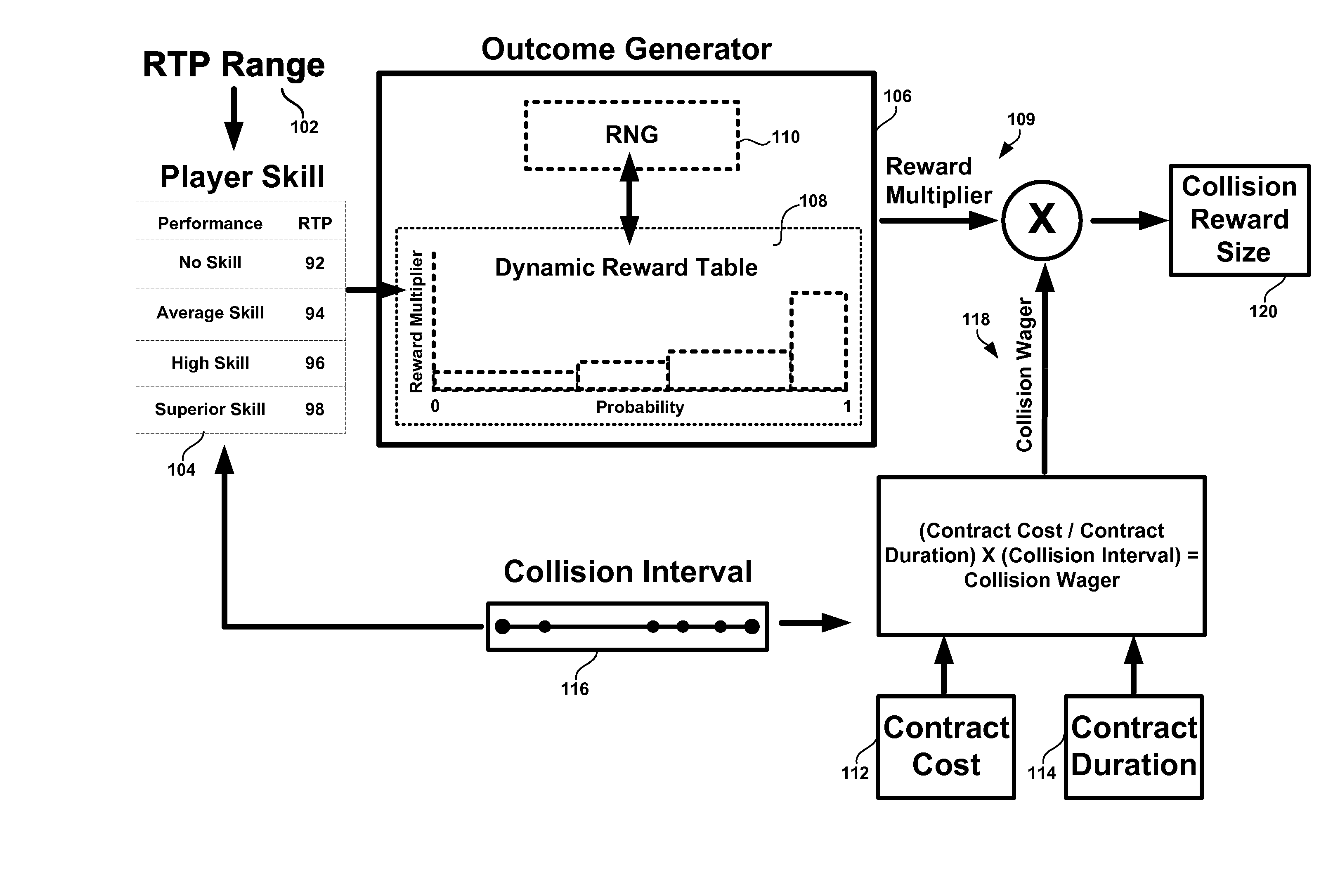

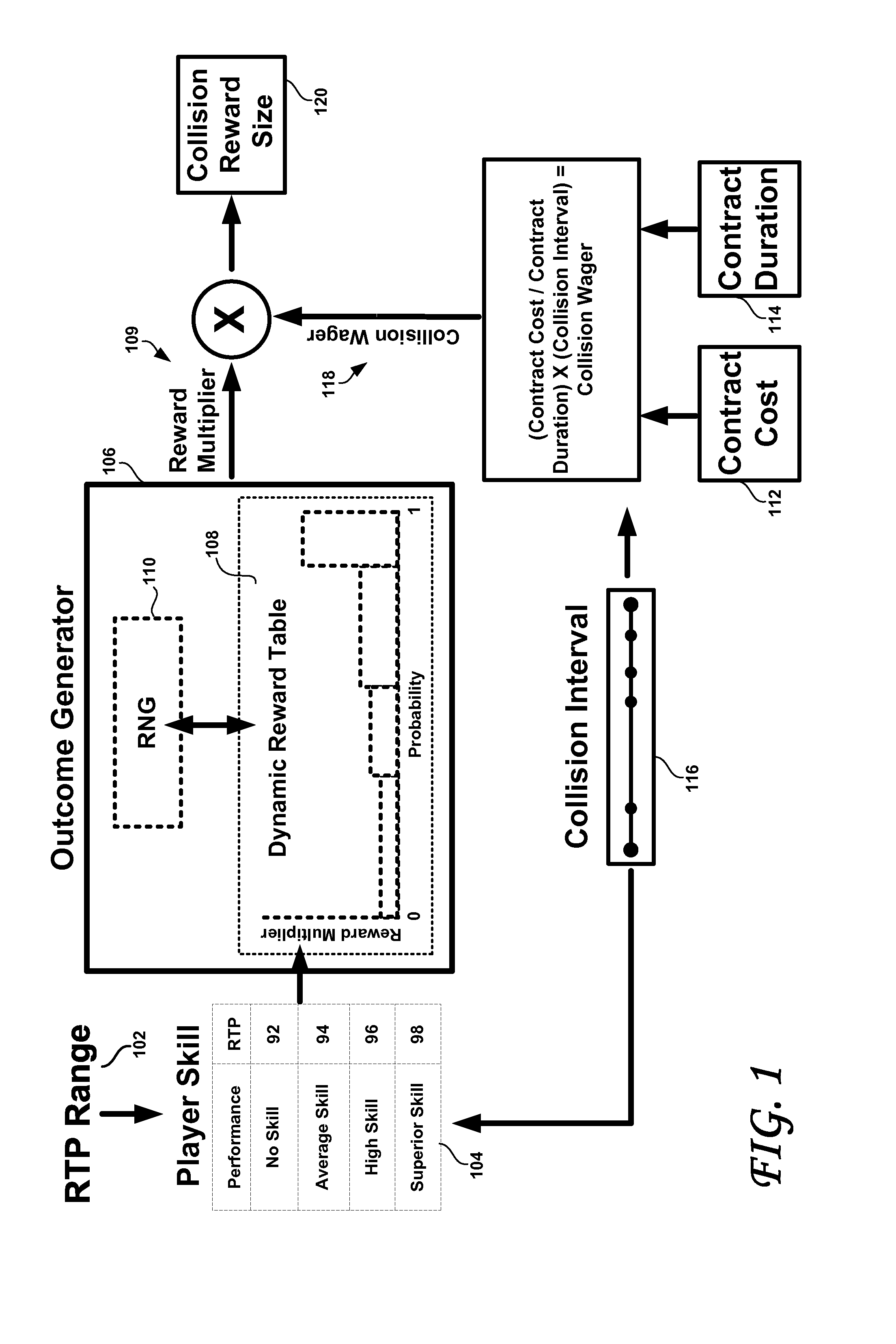

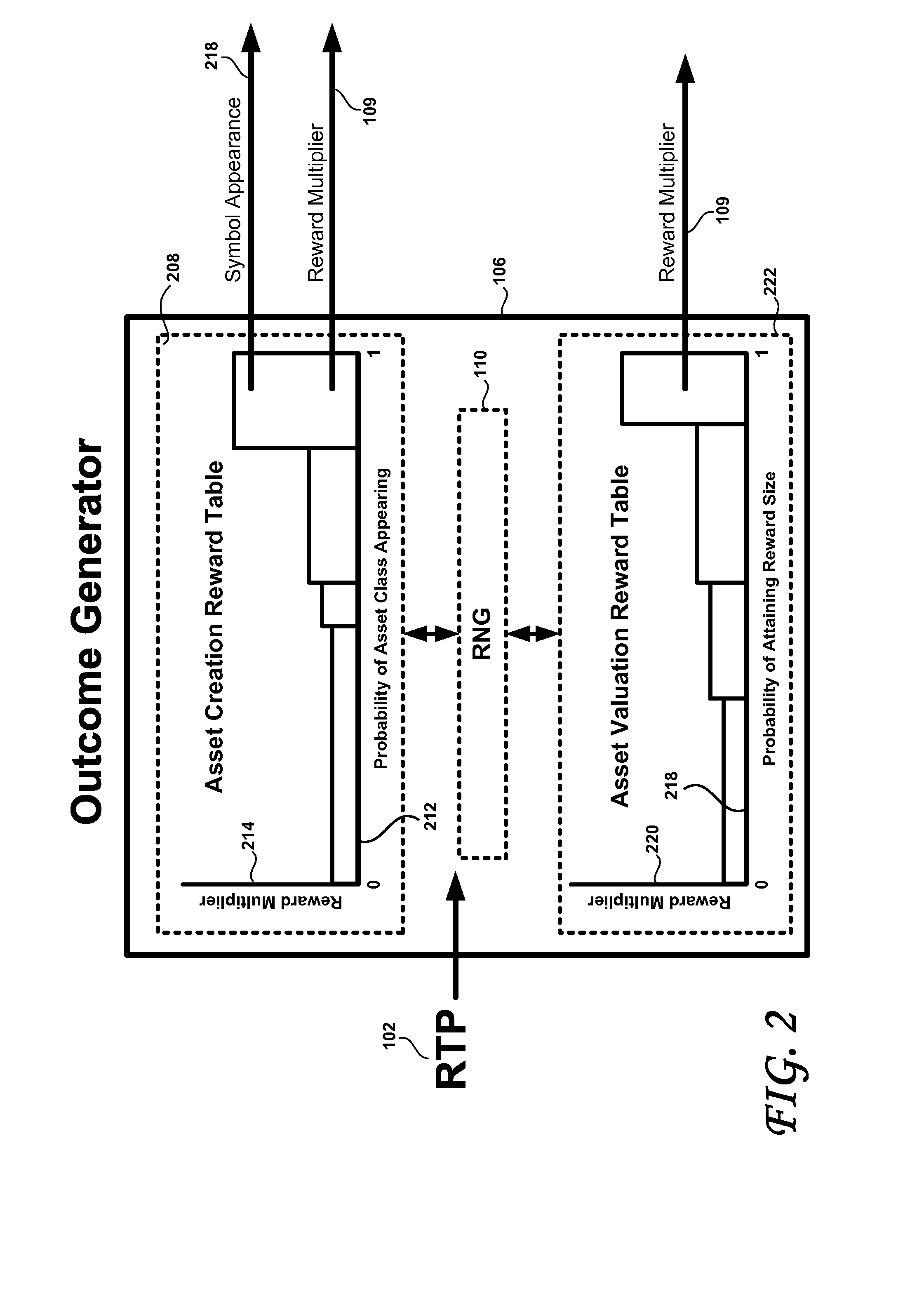

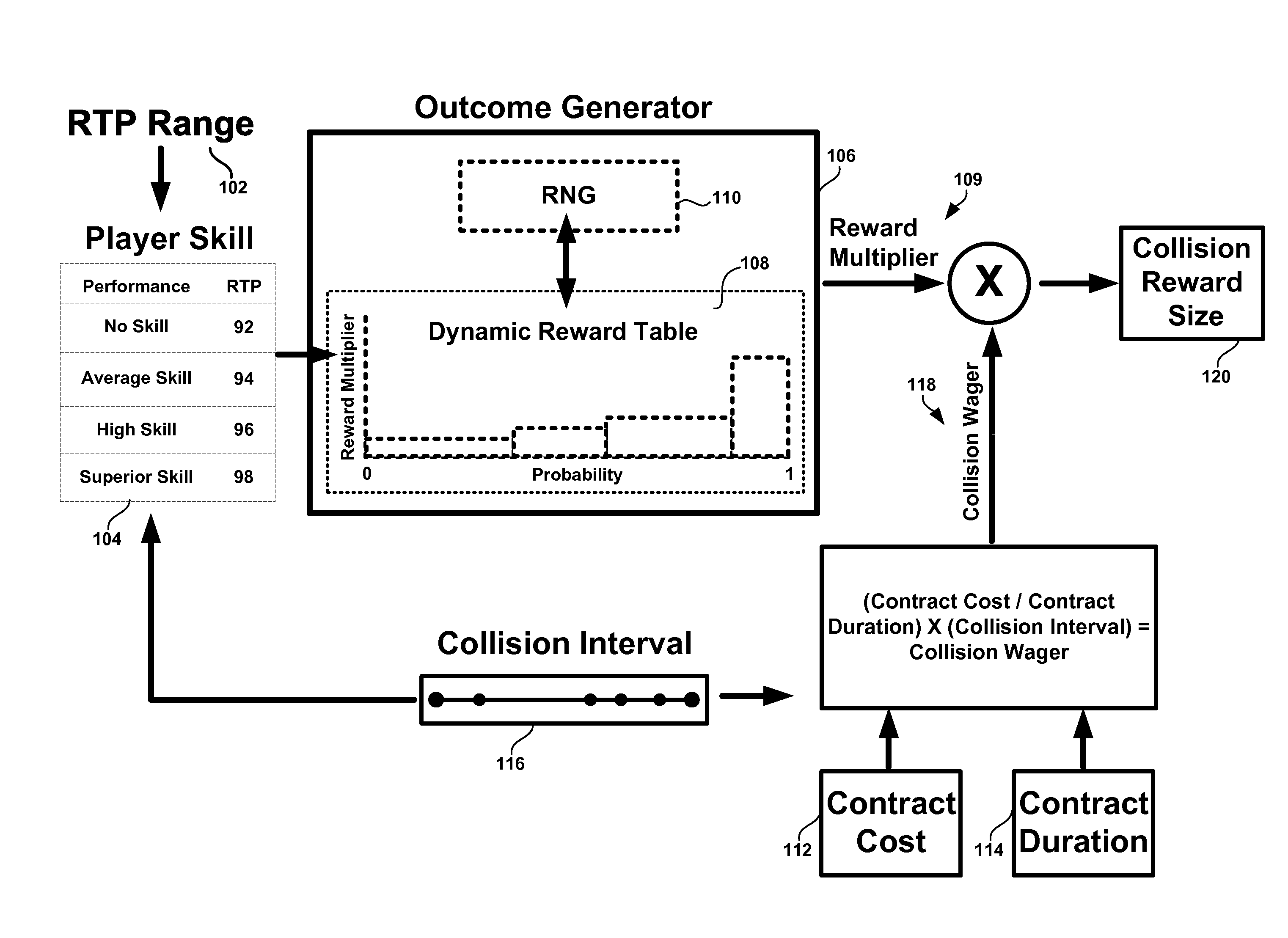

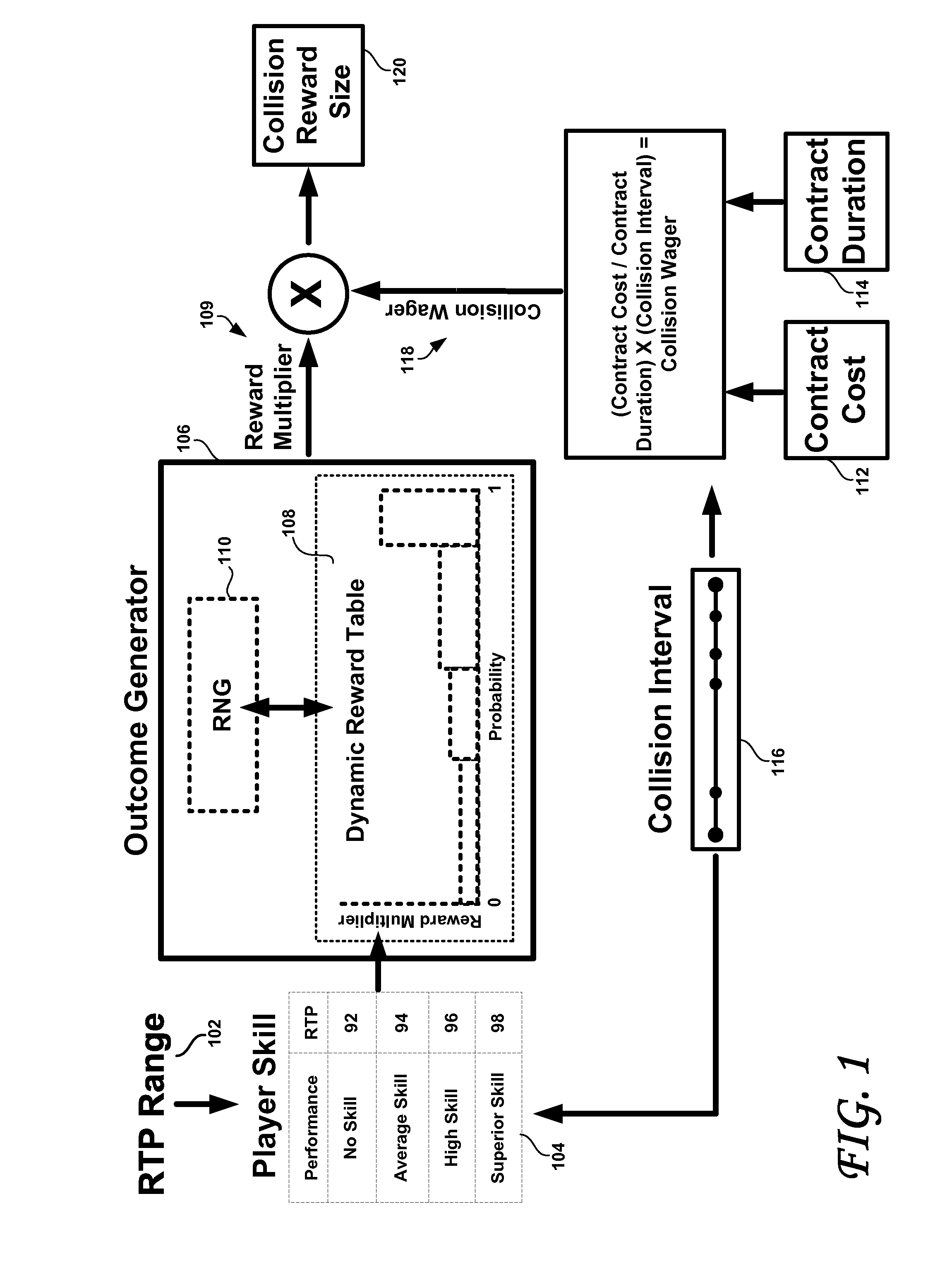

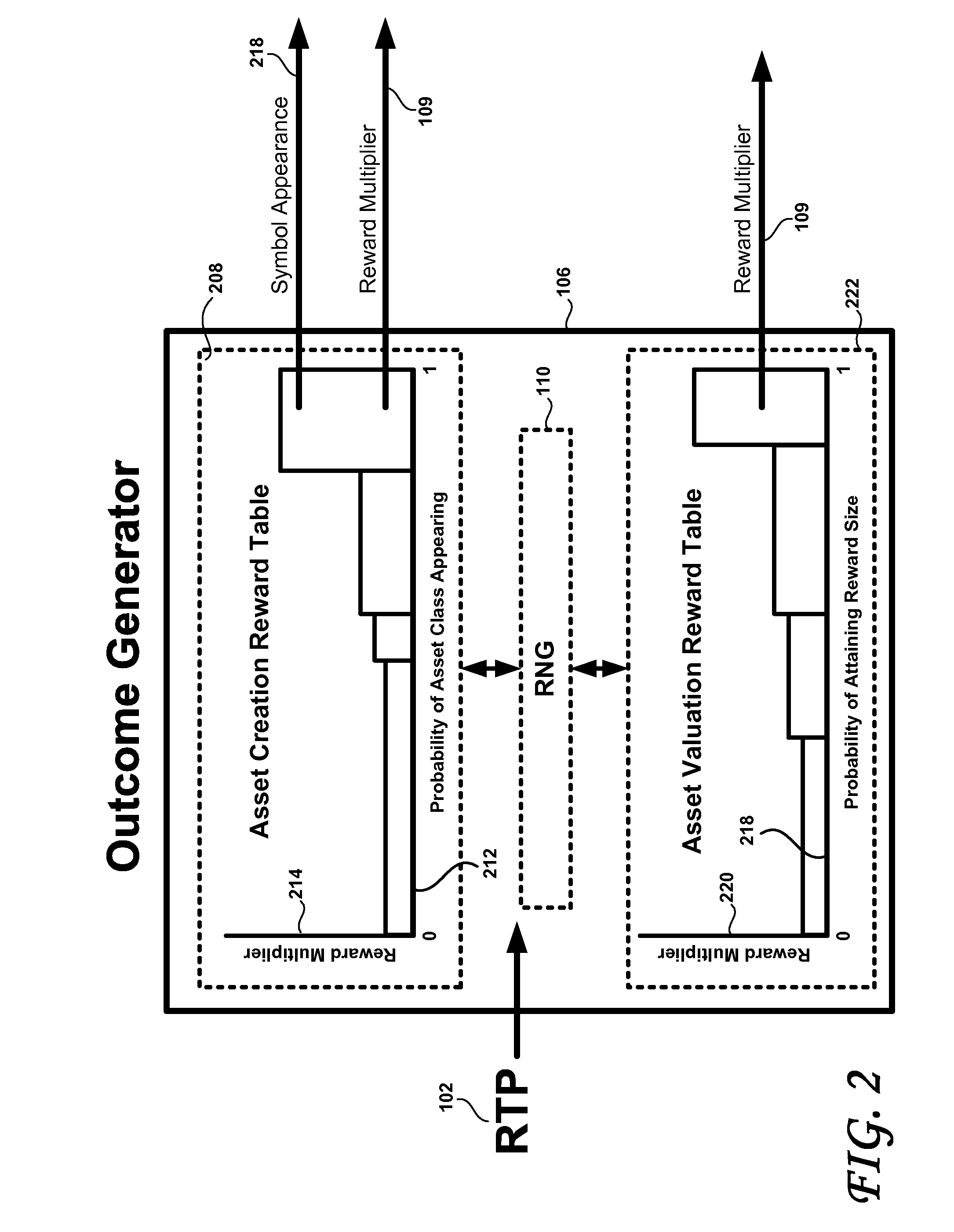

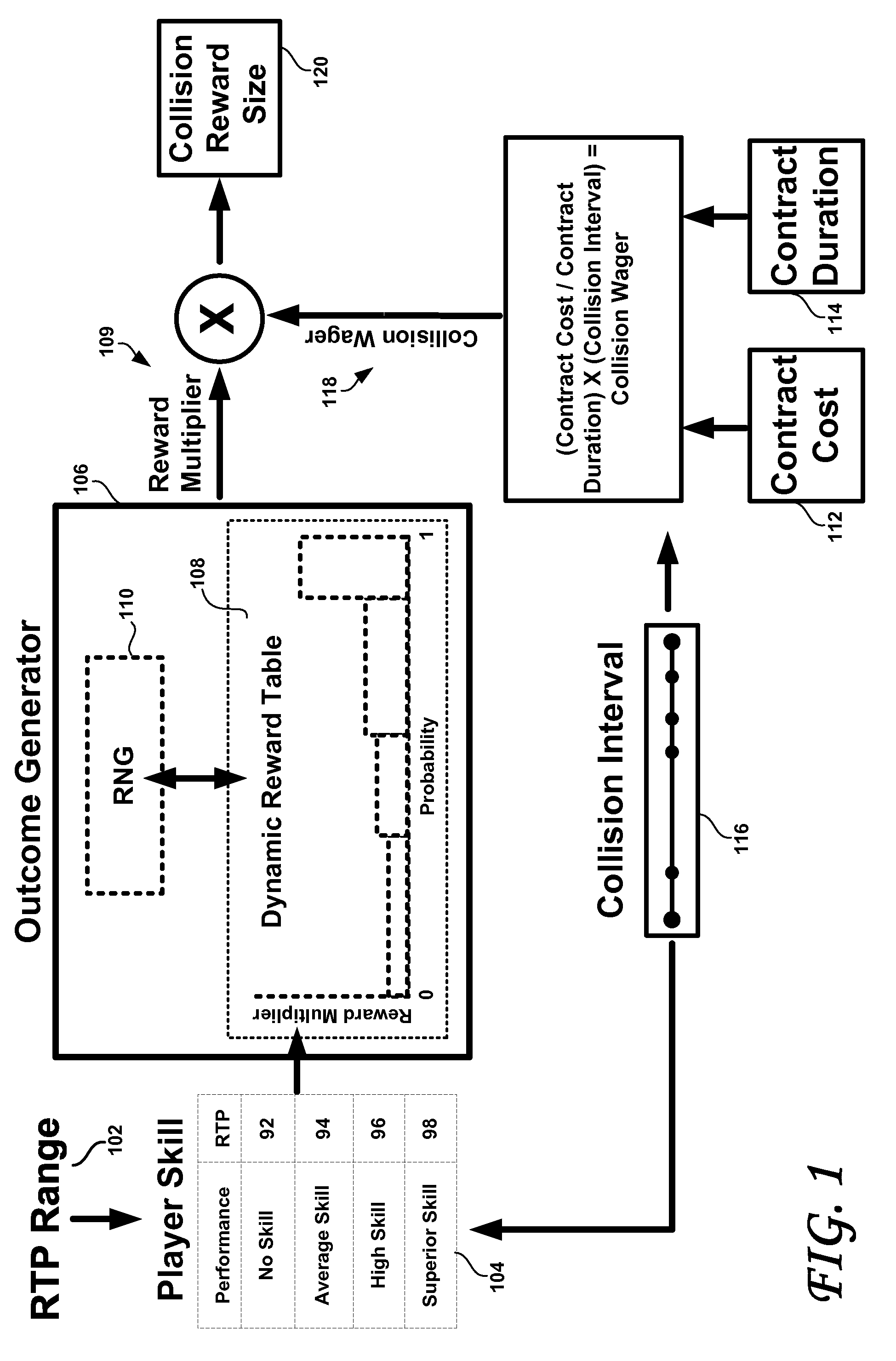

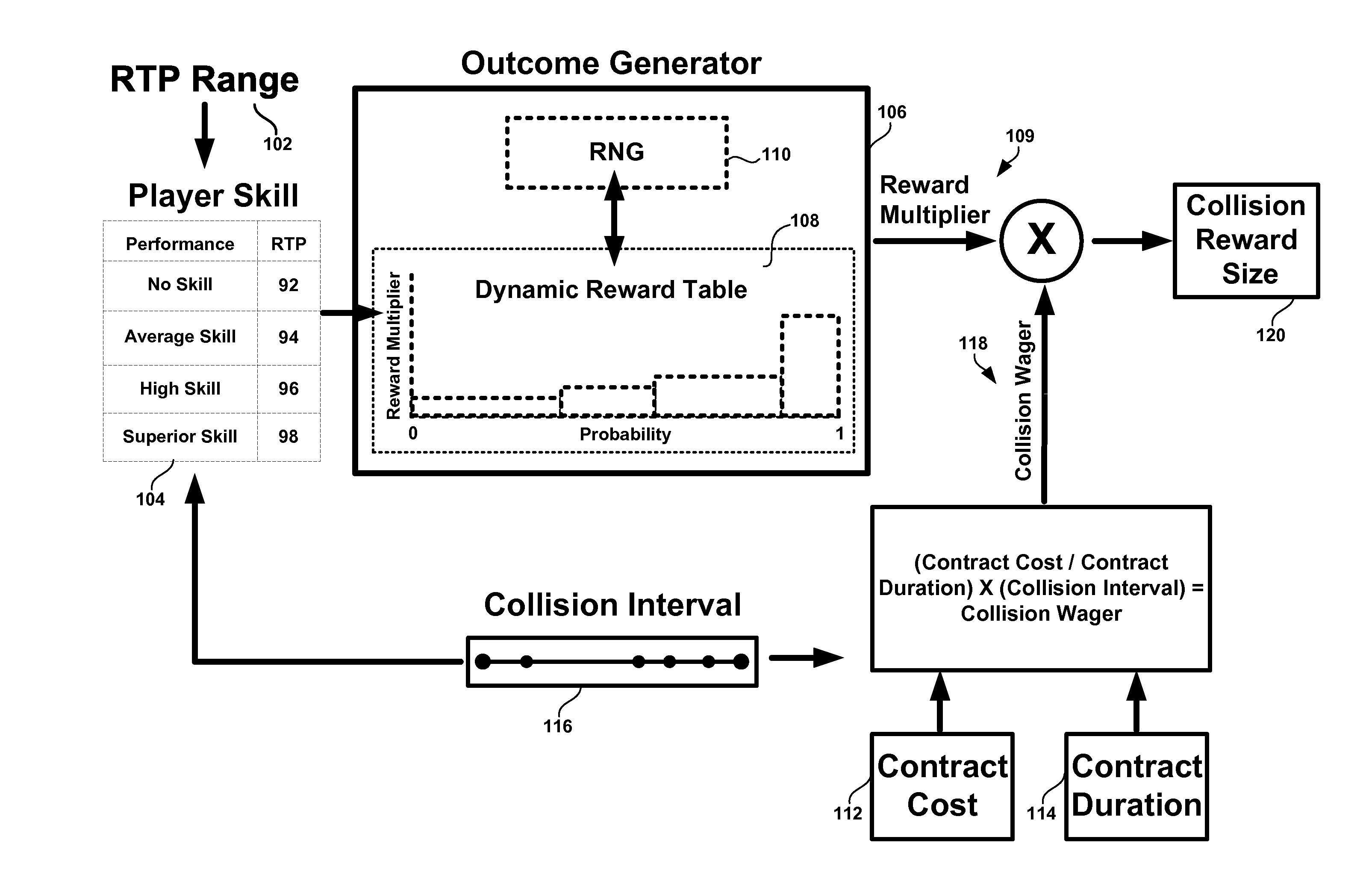

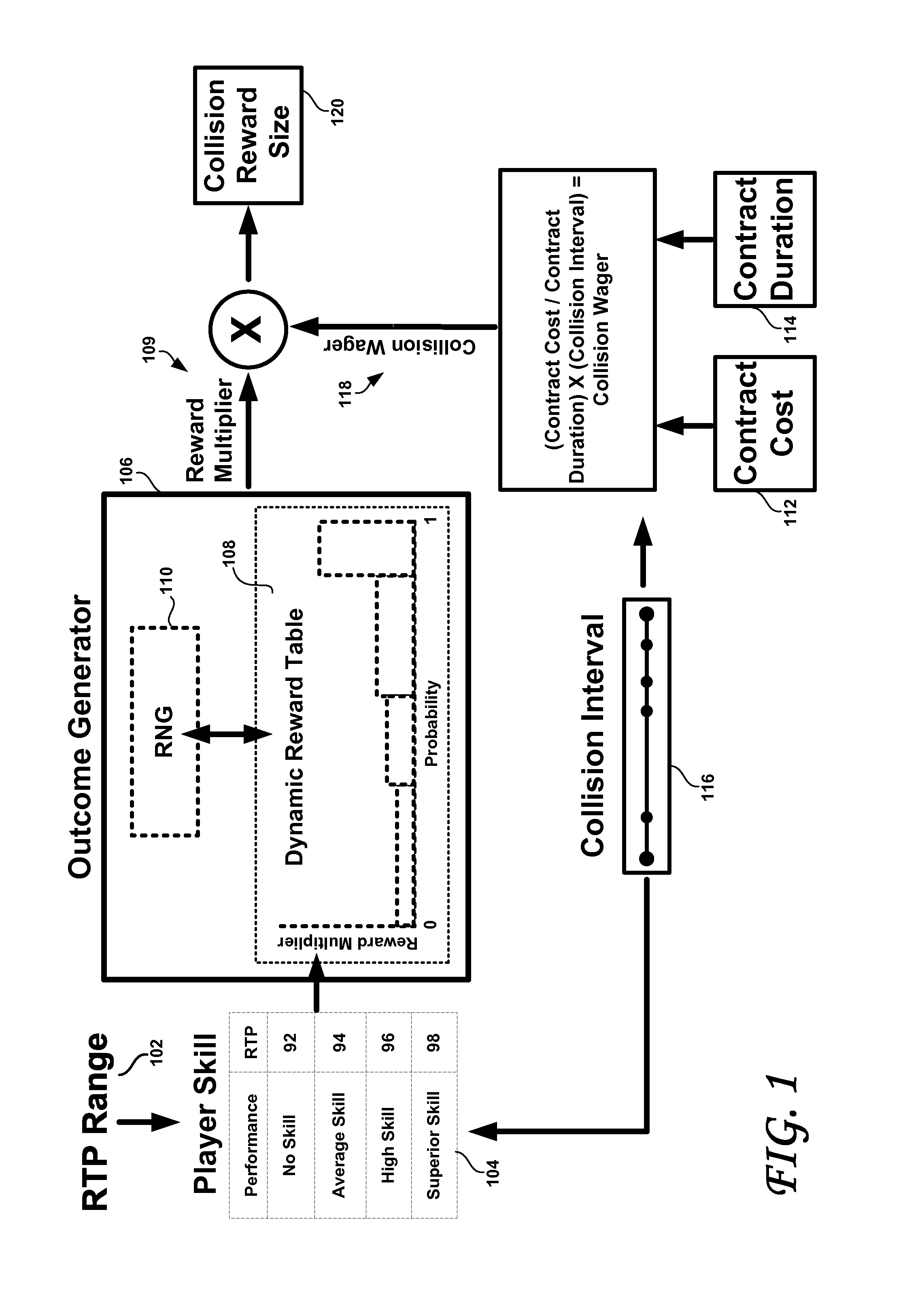

The Return Driven Casino Game Outcome Generator makes the first true class of casino video game possible by creating games that measure and reward skills like fast reflexes and manual dexterity while earning consistent and reliable profits for game operators. An RDOG gaming machine may include a game that includes a reward generating assets and a graphic shown on a display. The graphic is at least partially controlled by the player and configured to interact with the reward generating asset. A reward table is associated with the reward generating assets and is configured such that when the graphic successfully interacts therewith on the display, a random number is obtained and used as an index into the reward table to derive a reward multiplier. The reward due the player for successfully interacting with the reward generating asset may then be determined by a product of the reward multiplier and a collision wager that is dependent upon a time interval since a last successful interaction with the reward generating asset.

Owner:IGT

Return-driven casino game outcome generator

ActiveUS20090061991A1Positively affect their destinyHigh returnApparatus for meter-controlled dispensingVideo gamesReflexSkill sets

The Return Driven Casino Game Outcome Generator (RDOG) makes the first true class of casino video game possible by creating games that measure and reward skills like fast reflexes and manual dexterity while earning consistent and reliable profits for game operators. In RDOG, a method of determining a reward due to a player of a regulated game may include steps of enabling the player to interact with one or more reward generating assets within the regulated game; measuring a level of skill of the player in interacting with the reward generating assets, and determining the reward due to the player for each successful interaction with the reward generating assets, the reward being determined according to the measured skill level, a random number and the time elapsed since a last successful interaction with any one of the reward generating assets.

Owner:IGT

Return-driven casino game outcome generator

ActiveUS20090061997A1Positively affect their destinyHigh returnApparatus for meter-controlled dispensingVideo gamesReflexSkill sets

The Return Driven Casino Game Outcome Generator makes the first true class of casino video game possible by creating games that measure and reward skills like fast reflexes and manual dexterity while earning consistent and reliable profits for game operators. In RDOG, a method of determining a reward due to a player of a regulated game may include steps of enabling the player to interact with one or more reward generating assets within the regulated game; measuring a level of skill of the player in interacting with reward generating assets, and determining the reward due to the player for each successful interaction with a reward generating asset, the reward being determined according to the measured skill level, a random number and a time elapsed since a last successful interaction with any one of the reward generating asset.

Owner:IGT

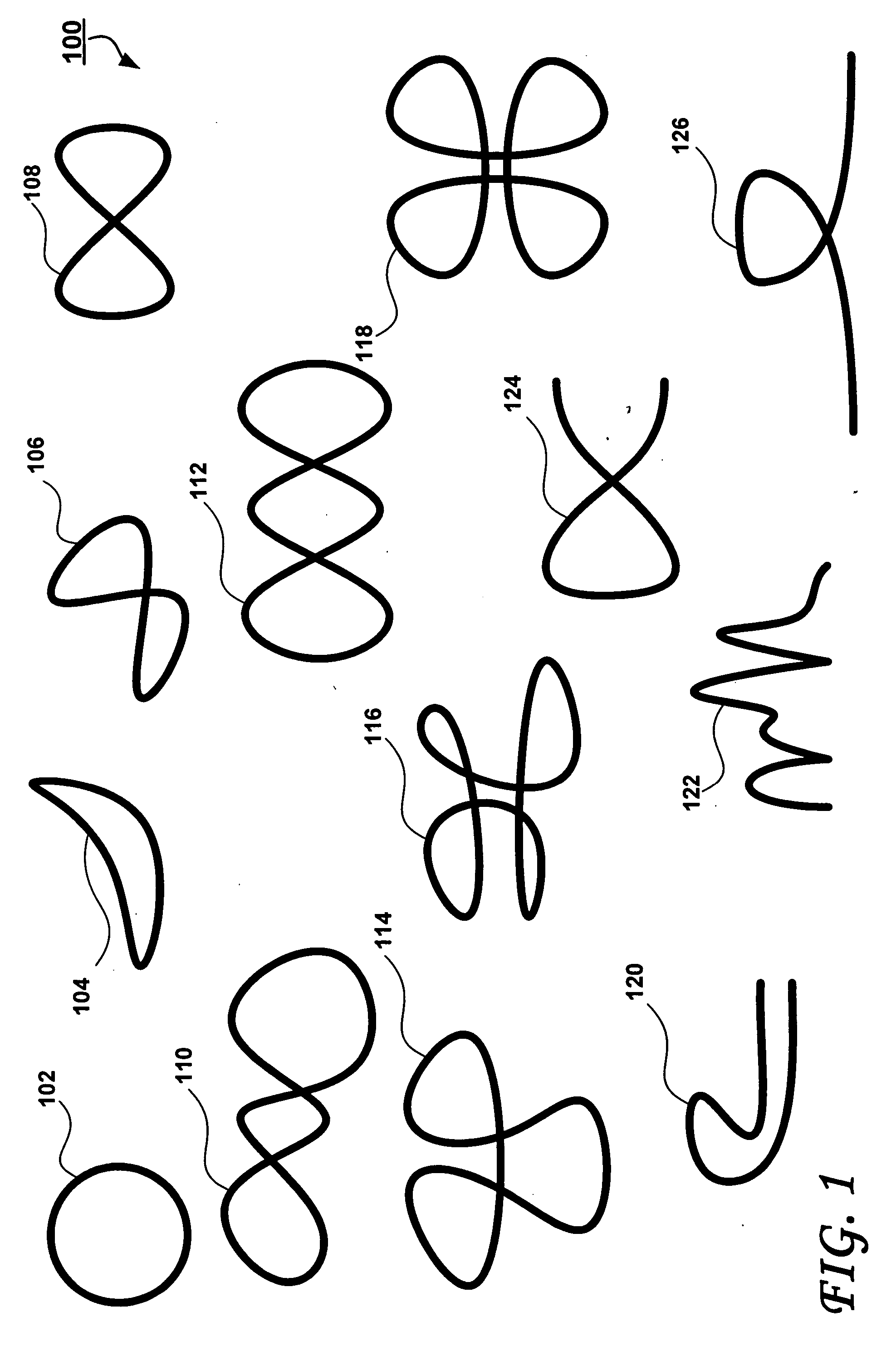

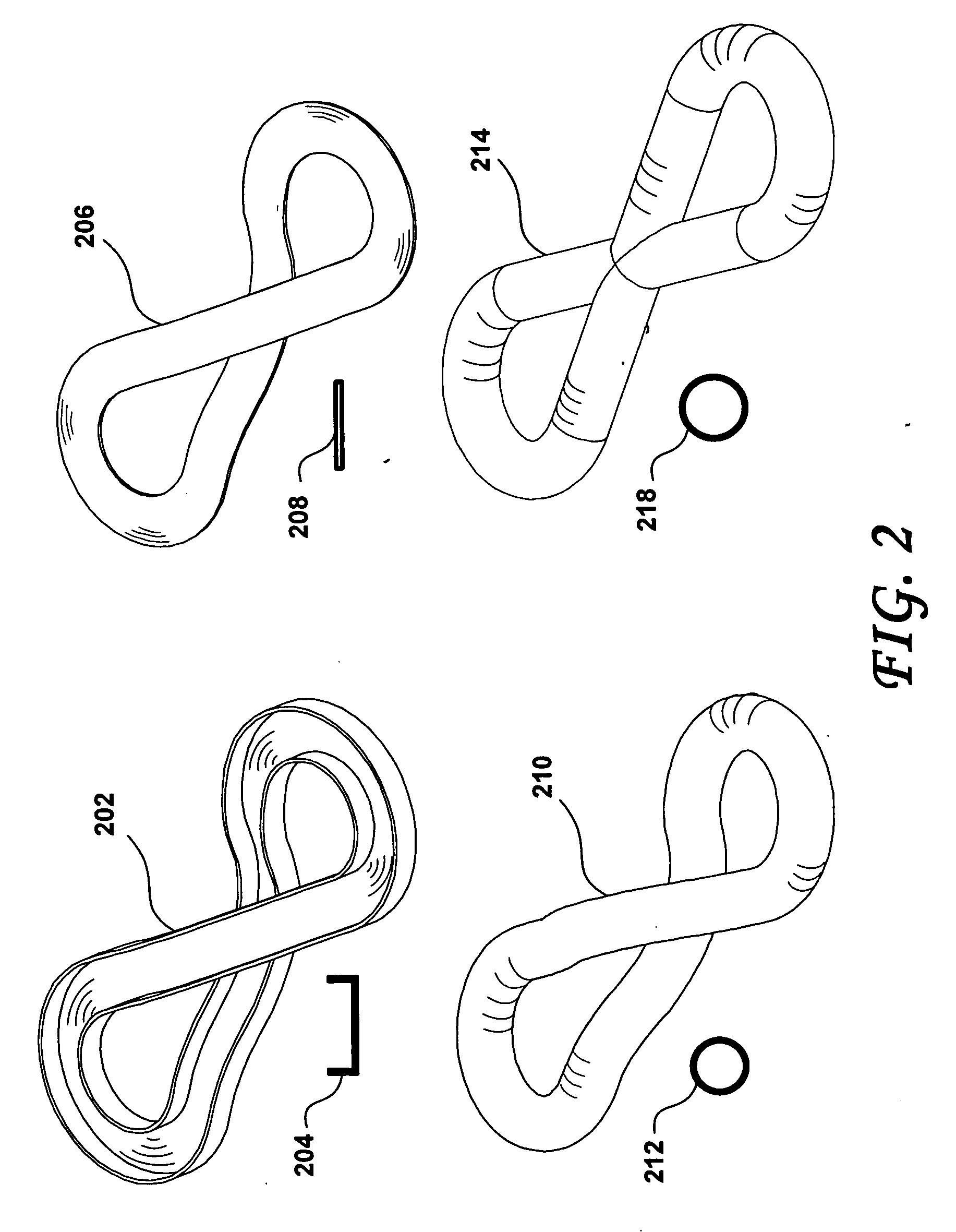

Multimedia conceptual search system and associated search method

InactiveUS20070130112A1High returnLess sensitive to lighting conditionMultimedia data indexingSpecial data processing applicationsPattern perceptionWeb crawler

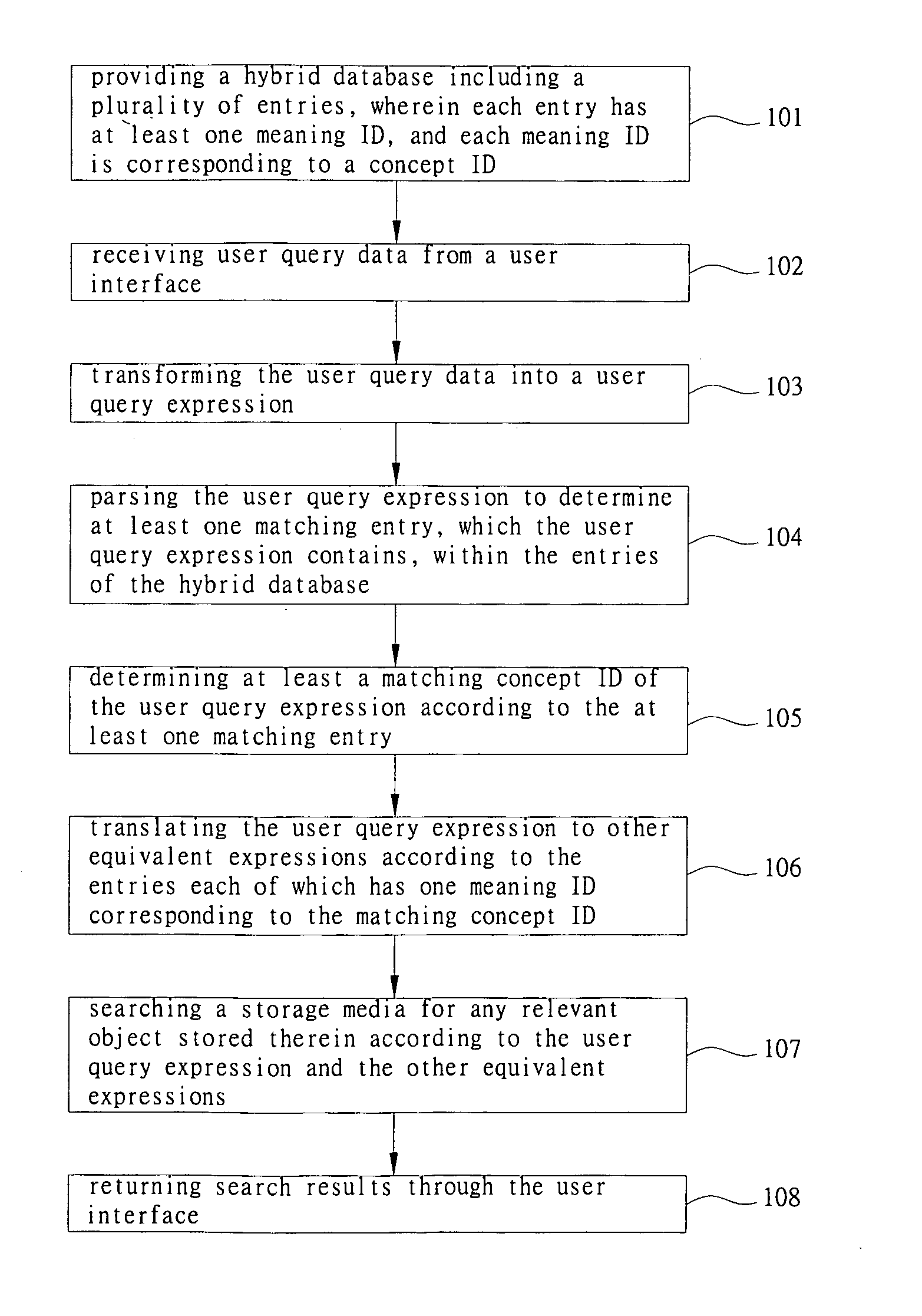

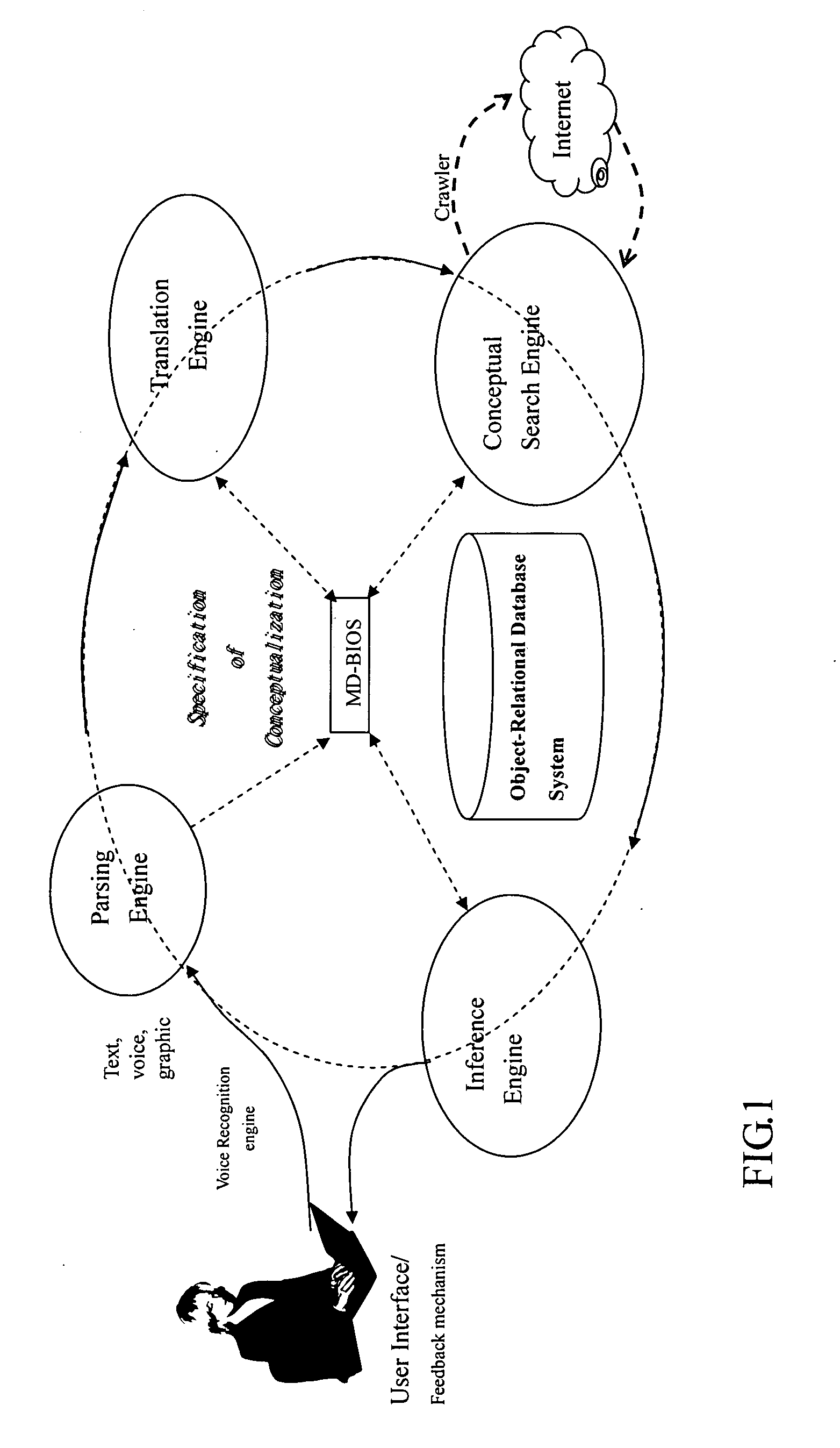

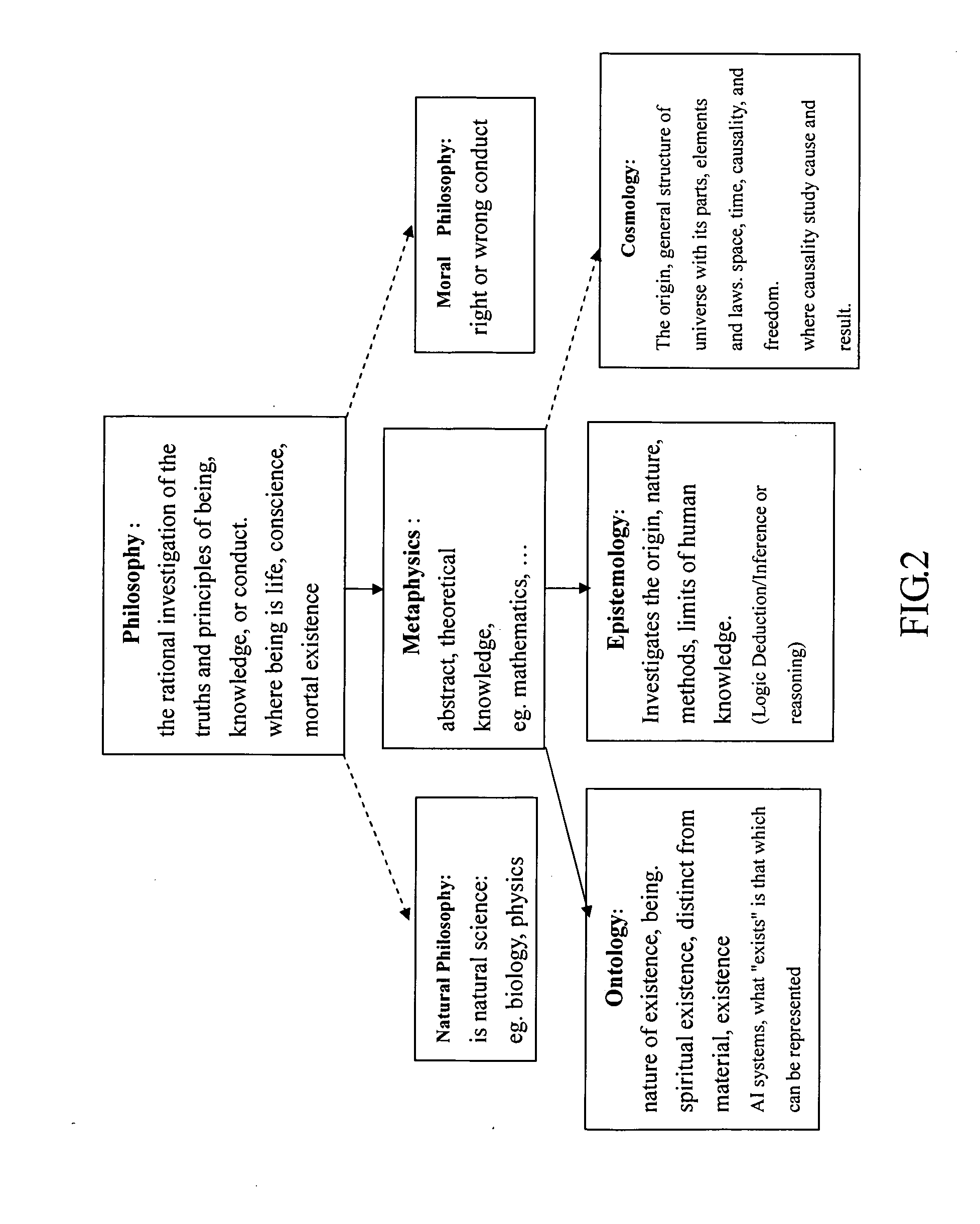

The current disclosure uses the disciplines of Ontology and Epistemology to implement a context / content-based “multimedia conceptual search and planning”, in which the formation of conceptualization is supported by embedding multimedia sensation and perception into a hybrid database. The disclosed system comprises: 1) A hybrid database model to host concept setup. 2) A graphic user interface to let user freely issue searching request in text and graphic mode. 3) A parsing engine conducting the best match between user query and dictionaries, analyzing queried images, detecting and presenting shape and chroma, extracting features / texture of an object. (4) A translation engine built for search engine and inference engine in text and graphic mode. 5) A search engine using partitioned, parallel, hashed indexes from web crawler result, conducting search in formal / natural language in text and graphic mode. 6) A logic interference engine working in text and graphic mode, and 7) A learning / feedback interface.

Owner:INTELLIGENTEK CORP

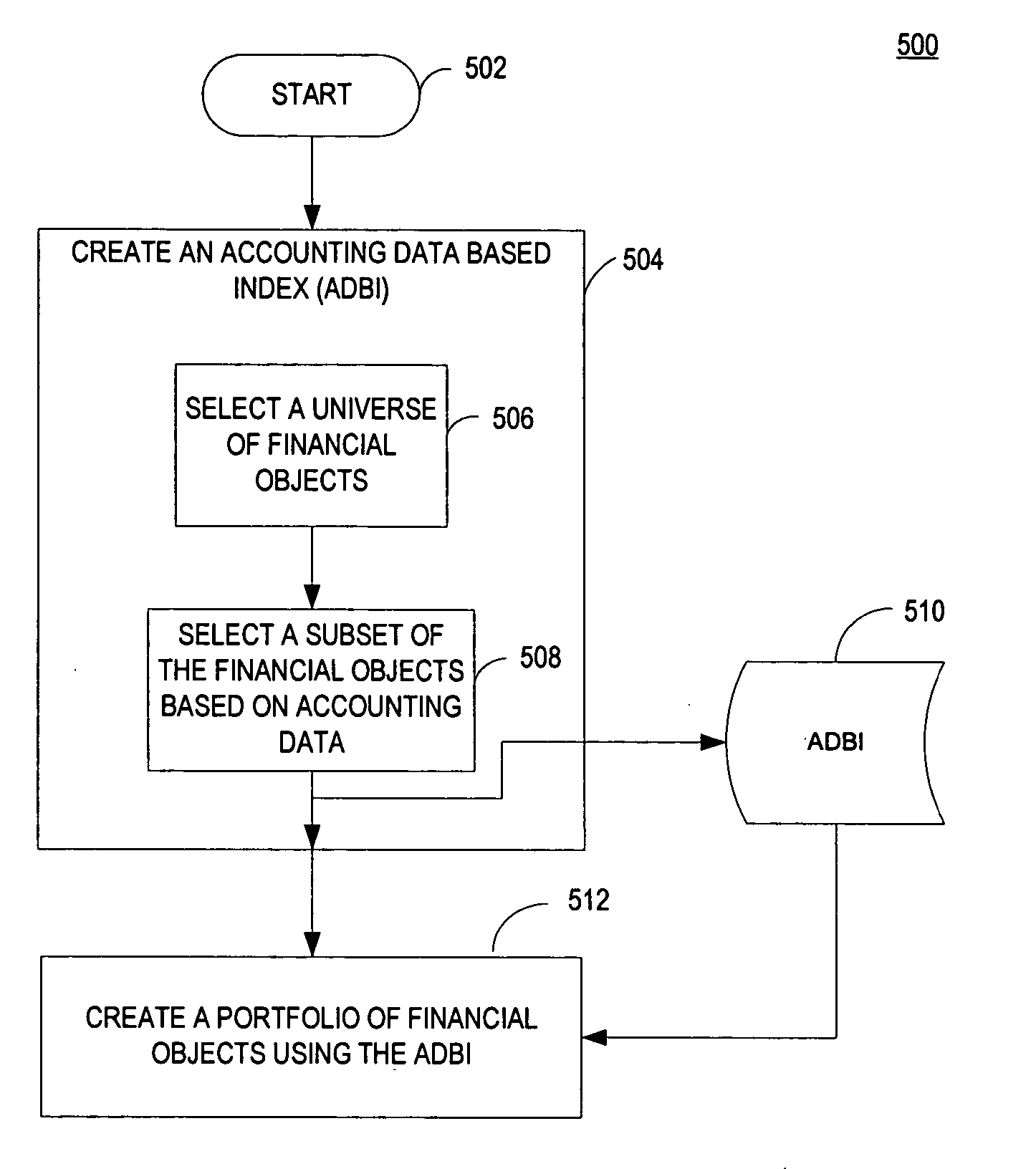

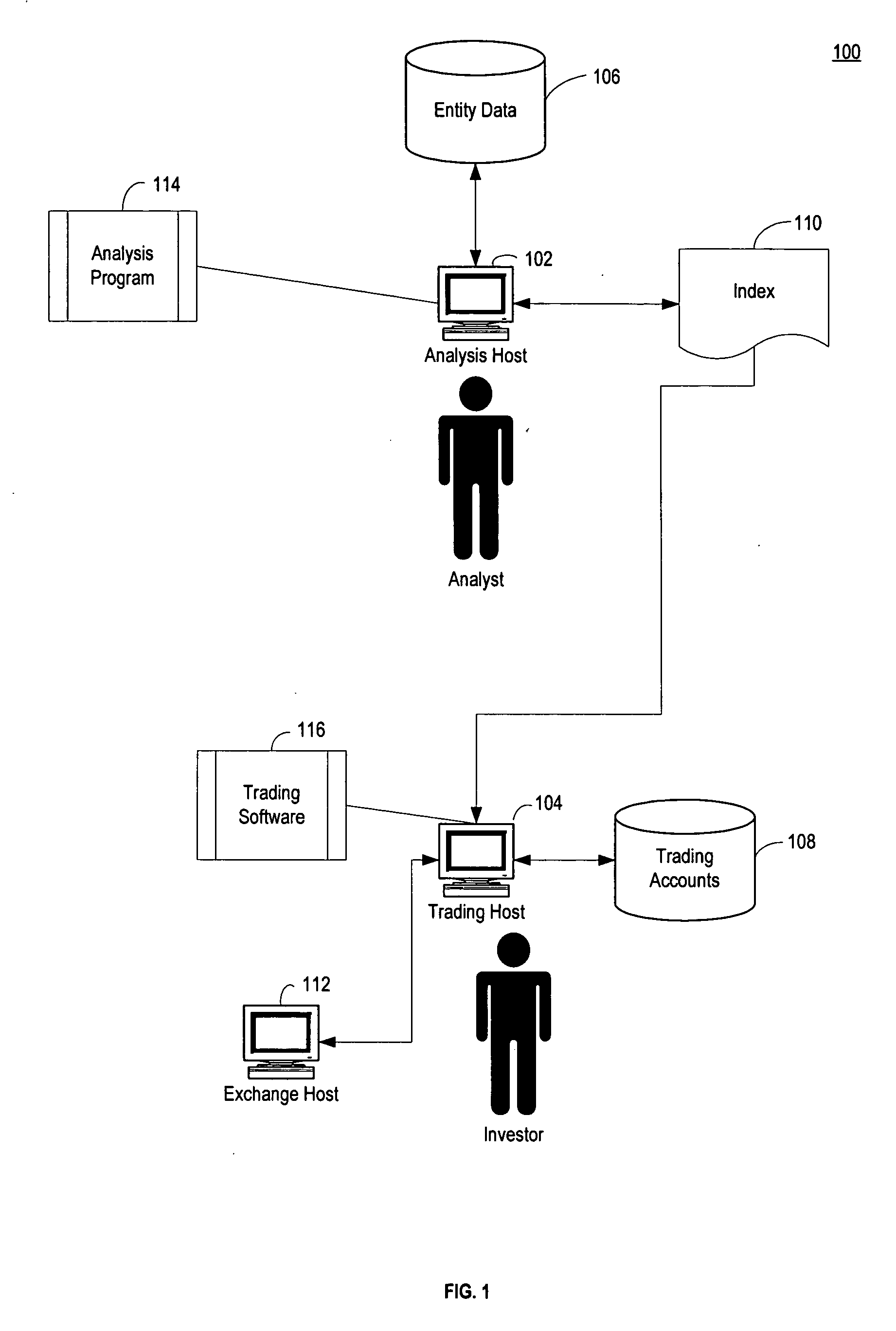

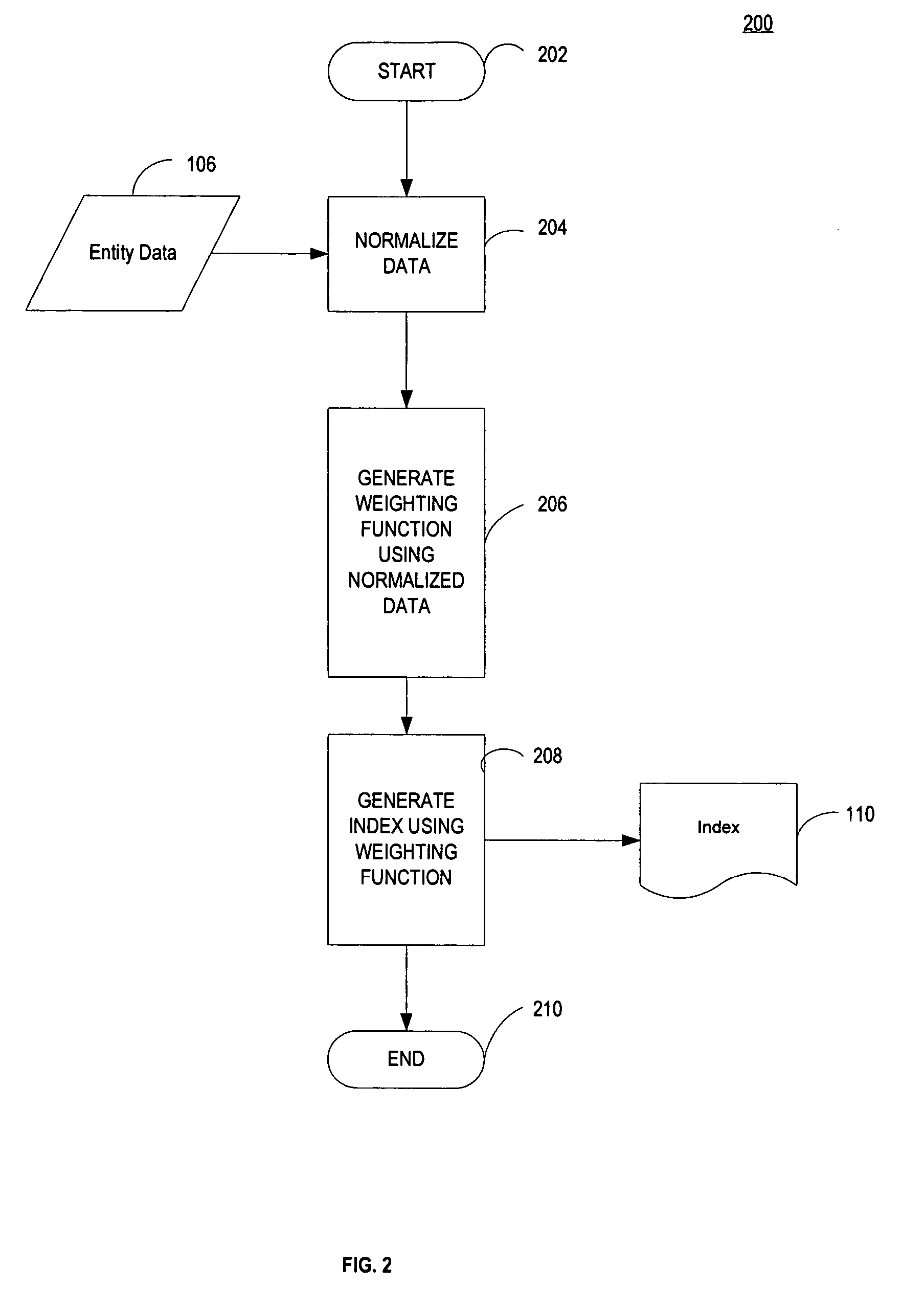

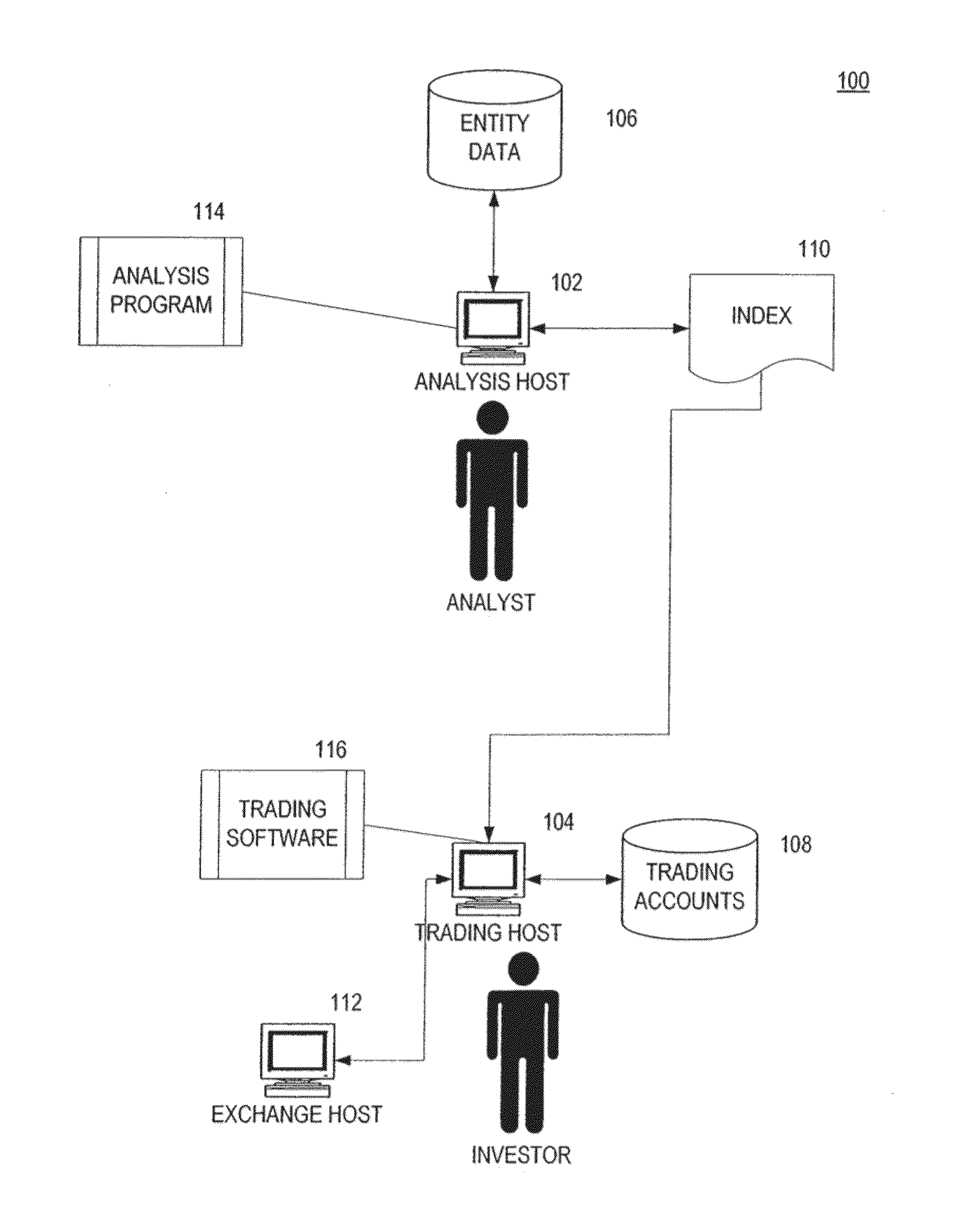

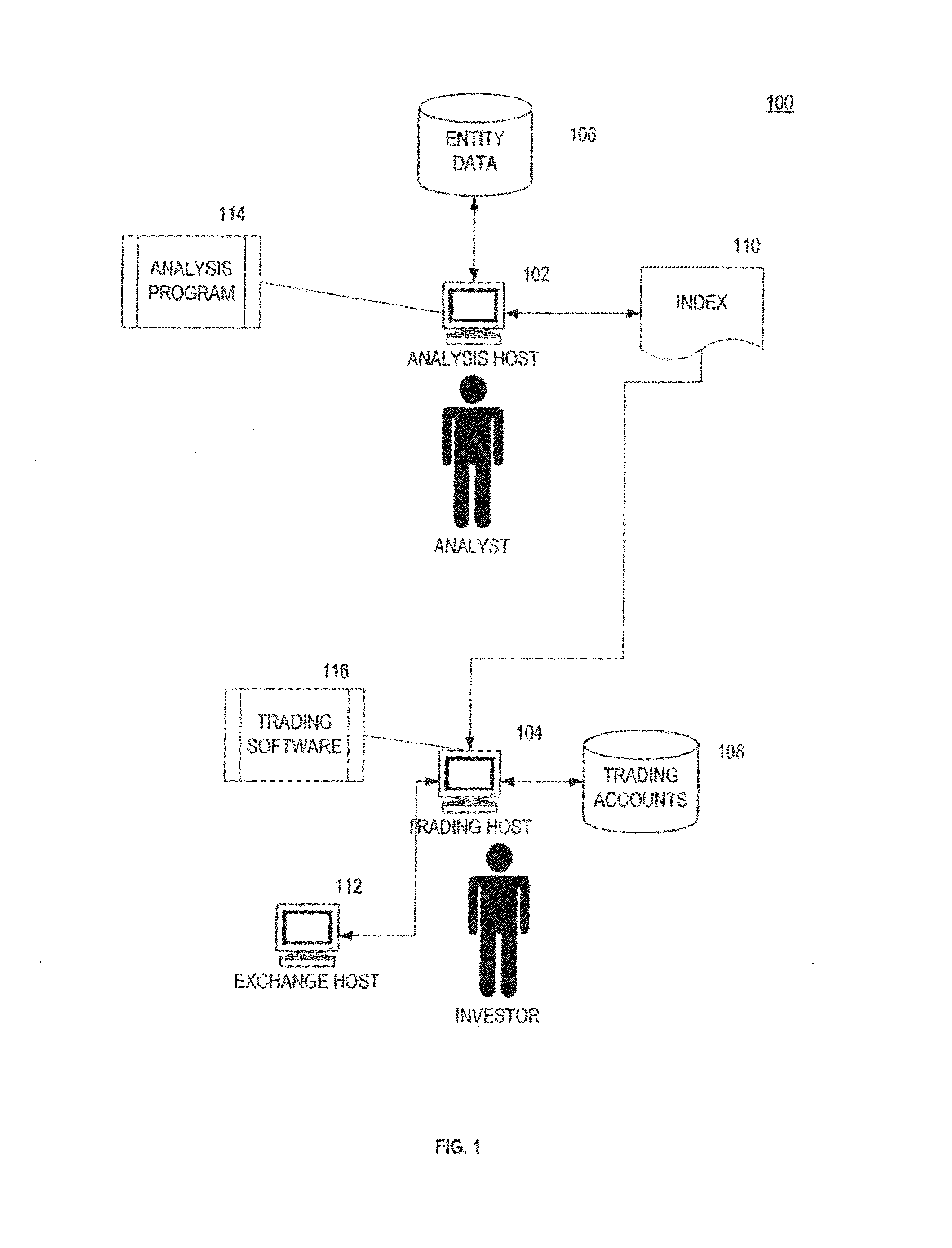

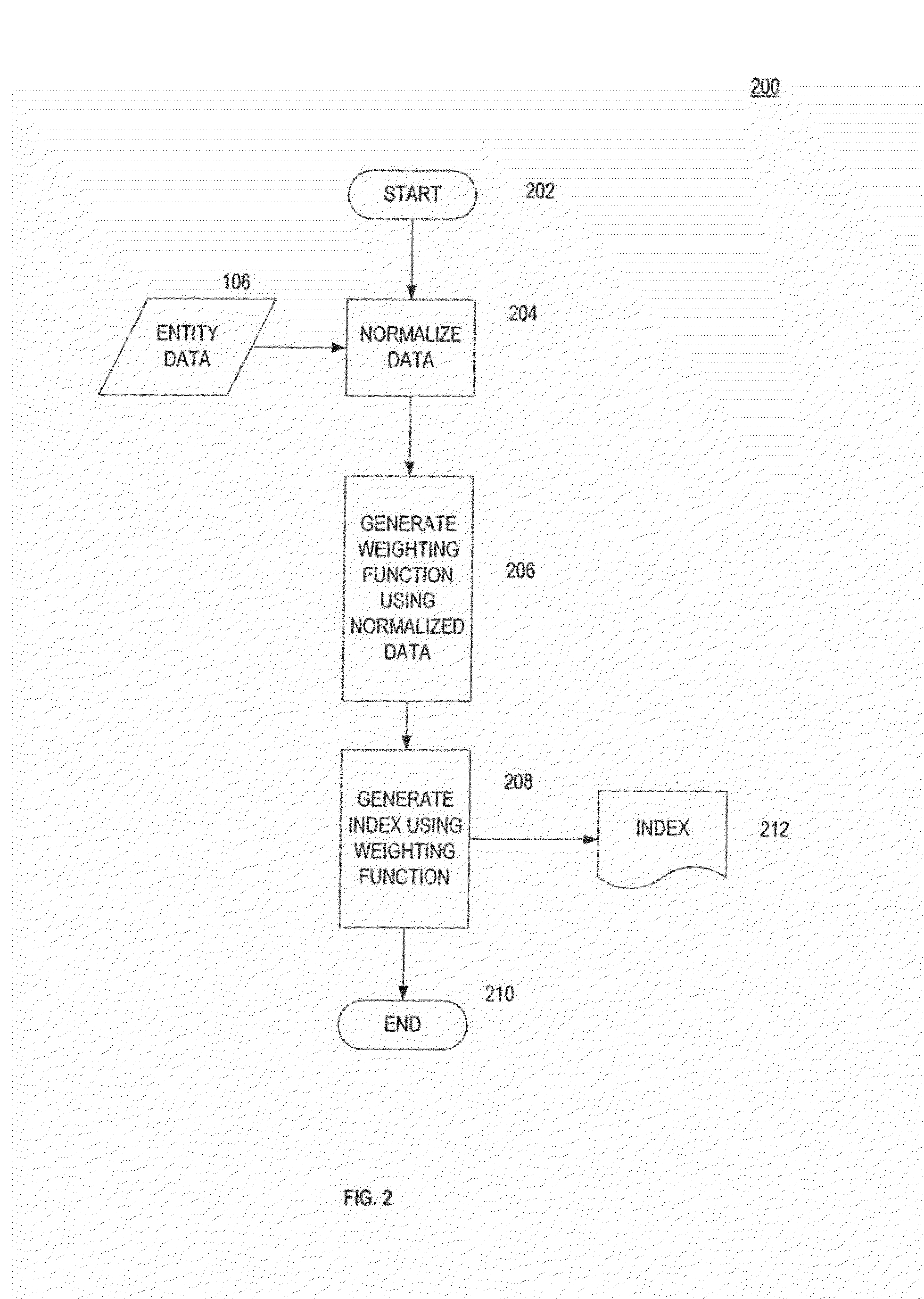

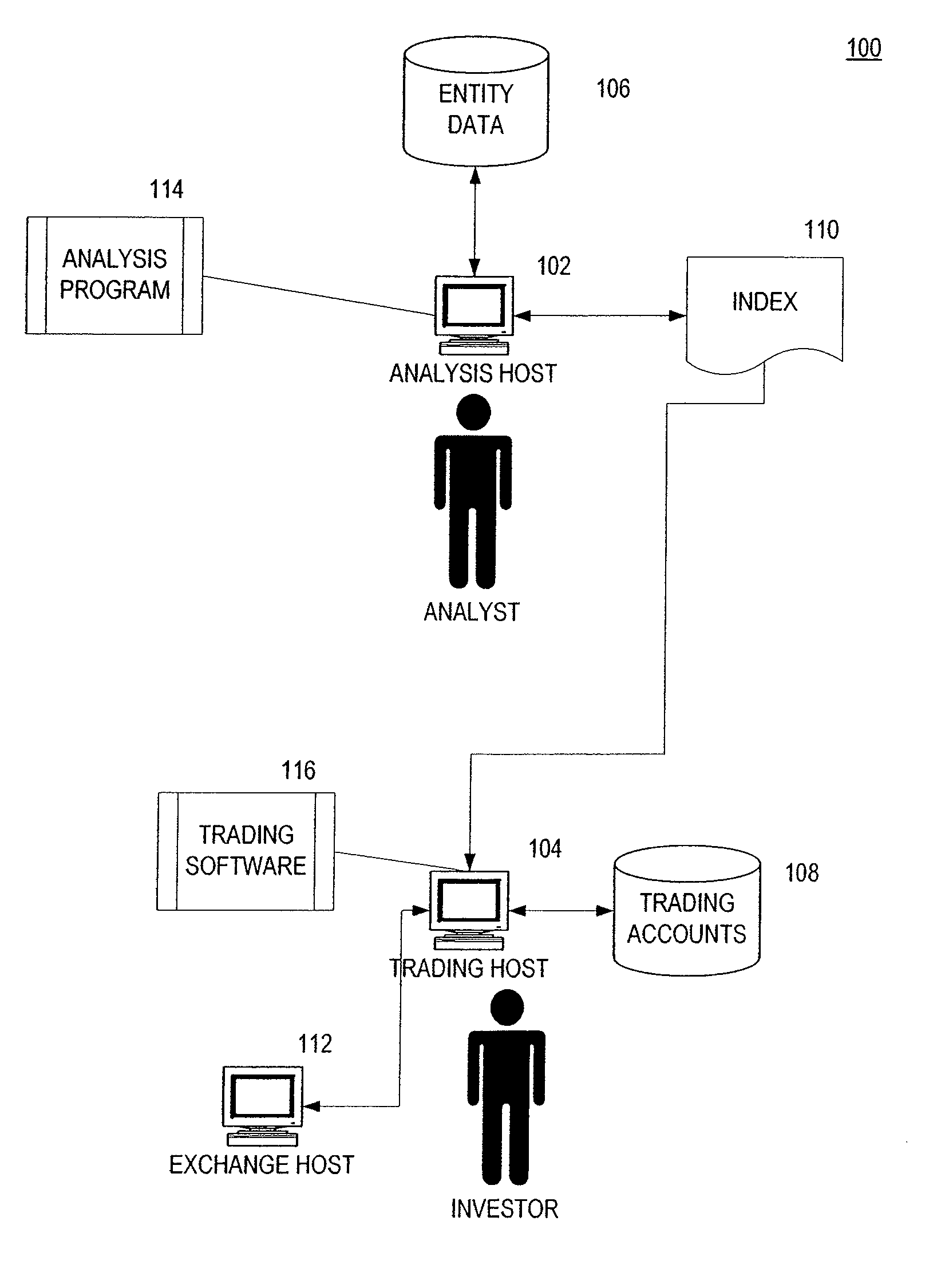

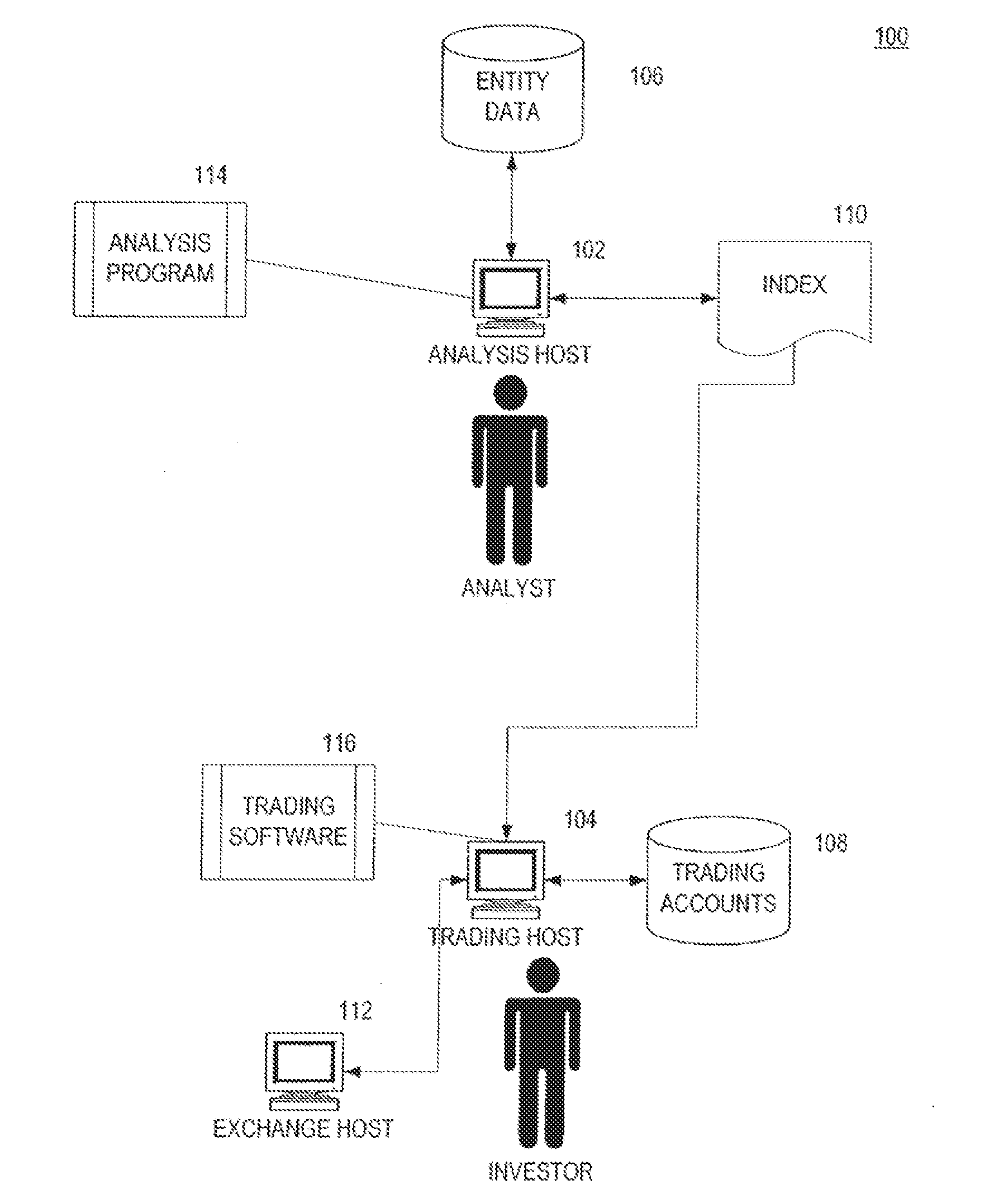

Using accounting data based indexing to create a portfolio of assets

ActiveUS20070055598A1Avoiding inherent valuation biasEffectively limit riskFinanceObject basedDatabase

A system, method and computer program product creates an index based on accounting based data, as well as a portfolio of financial objects based on the index where the portfolio is weighted according to accounting based data. A passive investment system may be based on indices created from various metrics. The indexes may be built with metrics other than market capitalization weighting, price weighting or equal weighting. Non-financial metrics may also be used to build indexes to create passive investment systems. Additionally, a combination of financial non-market capitalization metrics may be used along with non-financial metrics to create passive investment systems. Once the index is built, it may be used as a basis to purchase securities for a portfolio. Specifically excluded are widely-used capitalization-weighted indexes and price-weighted indexes, in which the price of a security contributes in a substantial way to the calculation of the weight of that security in the index or the portfolio, and equal weighting weighted indexes. Valuation indifferent indexes avoid overexposure to overvalued securities and underexposure to undervalued securities, as compared with conventional capitalization-weighted and price-weighted.

Owner:RES AFFILIATES LLC

Method of combining demography, monetary policy metrics, and fiscal policy metrics for security selection, weighting and asset allocation

A system, method and computer program product may combine metrics, and may use metrics to select or weight an index, select or weight a portfolio of financial objects, or be used to perform asset allocation. Financial and non-financial metrics may be used. Metrics based on accounting data, or other non-price metrics such as, e.g., demography, monetary policy metrics, and / or fiscal policy metrics, may be used. A combination of metrics may be used. Indexes may be built with combinations of metrics other than market capitalization weighting, price weighting or equal weighting. Once built, an index may be used as a basis to purchase securities for a portfolio. Specifically excluded are widely-used capitalization-weighted and price-weighted indexes, in which price of a security contributes in a substantial way to calculation of weight of that security in the index or the portfolio, and equal weighting weighted indexes. Indexes may be constructed to minimize volatility.

Owner:RES AFFILIATES LLC

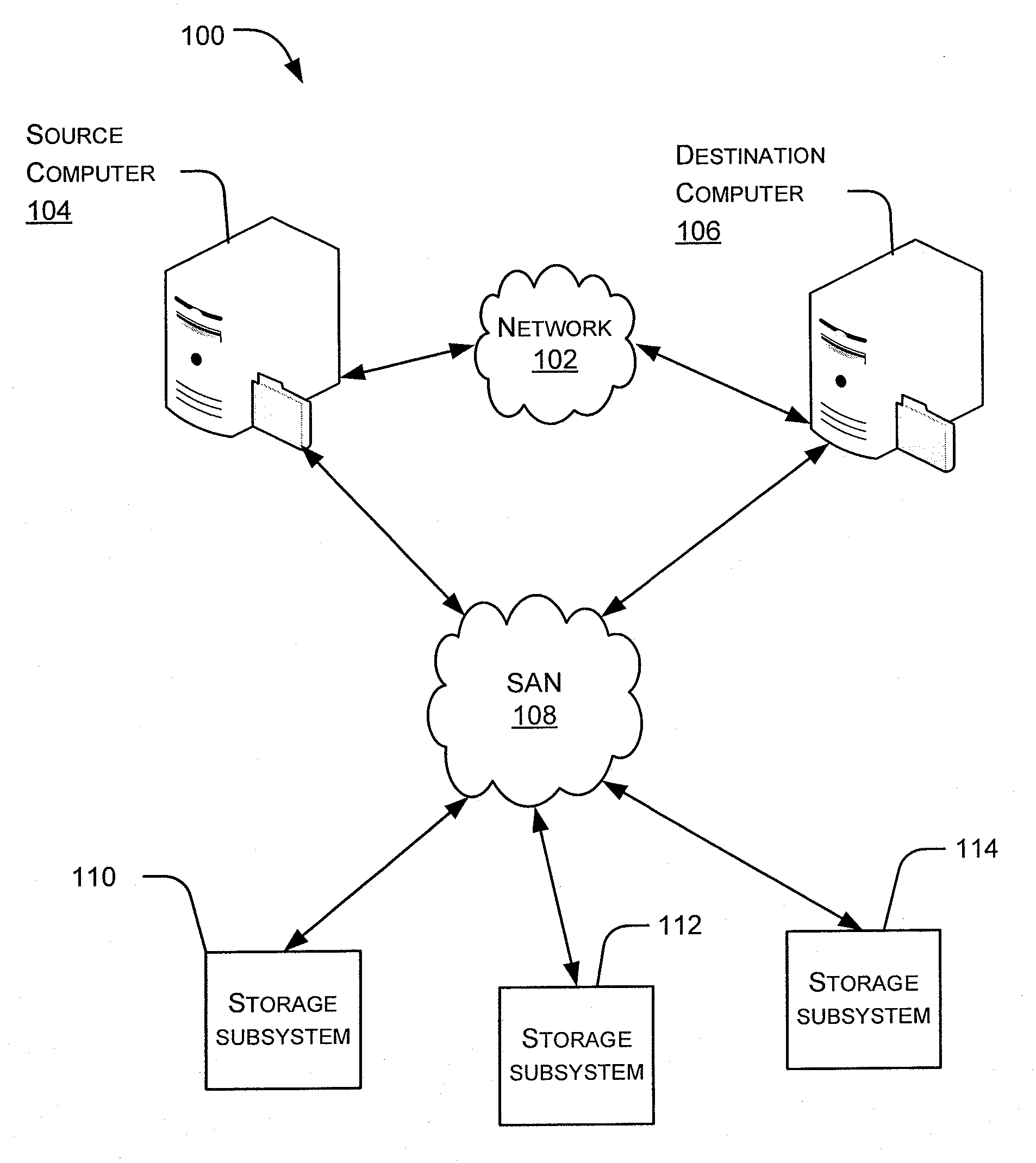

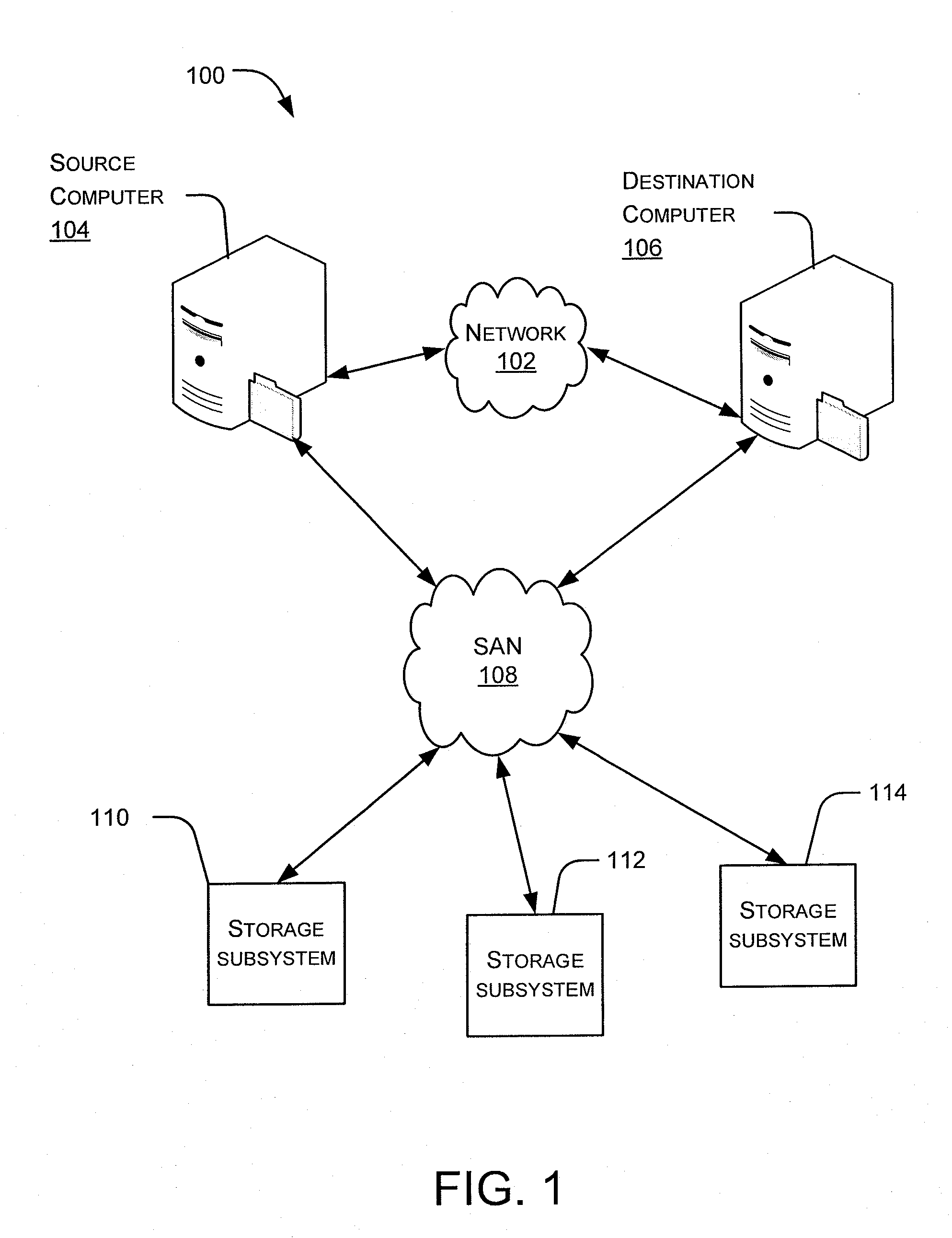

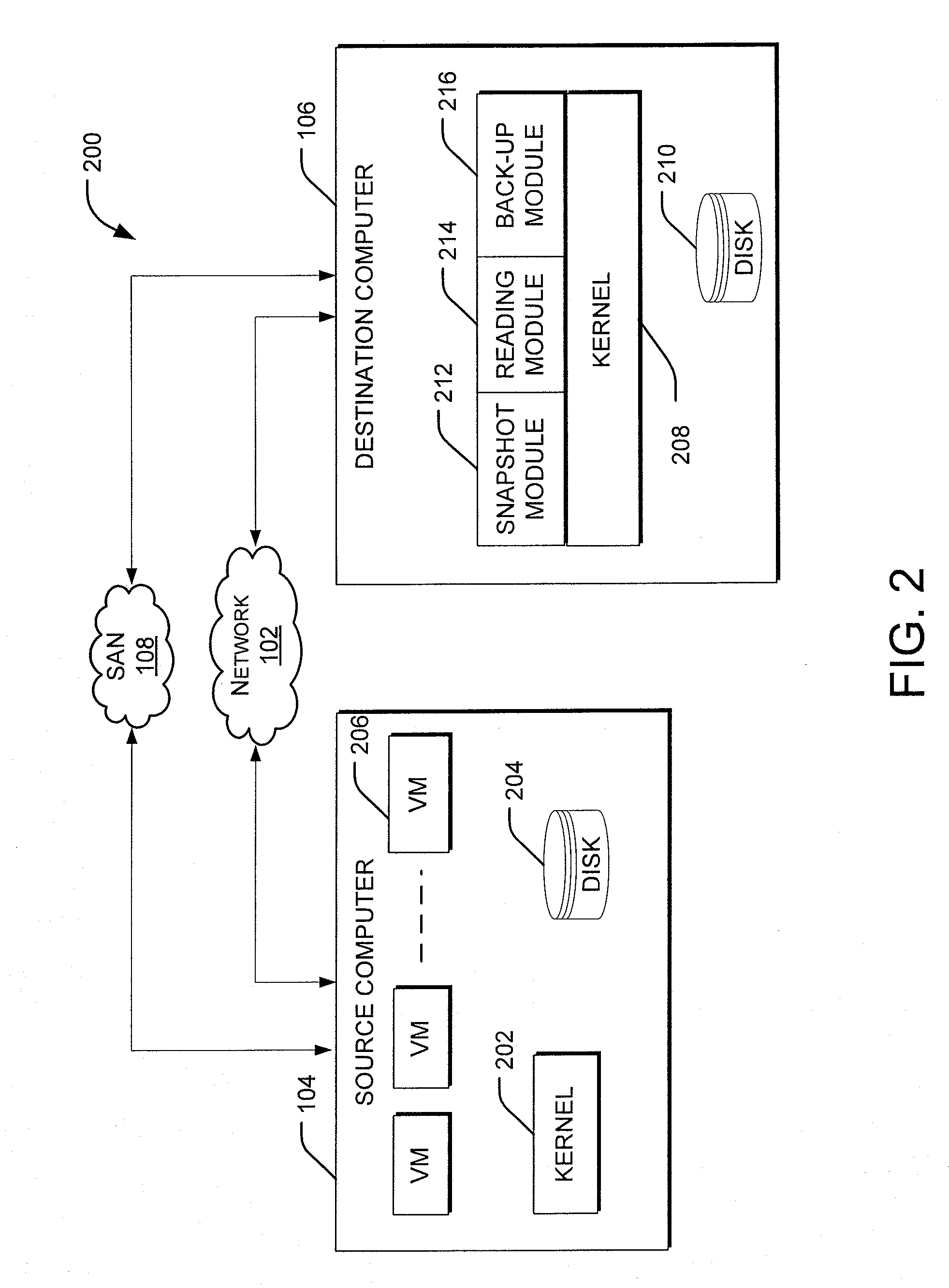

System and Method for Improving Performance of Data Container Backups

ActiveUS20110208928A1Improve performanceImprove efficiencyMemory loss protectionError detection/correctionComputer scienceData retention

Owner:CA TECH INC

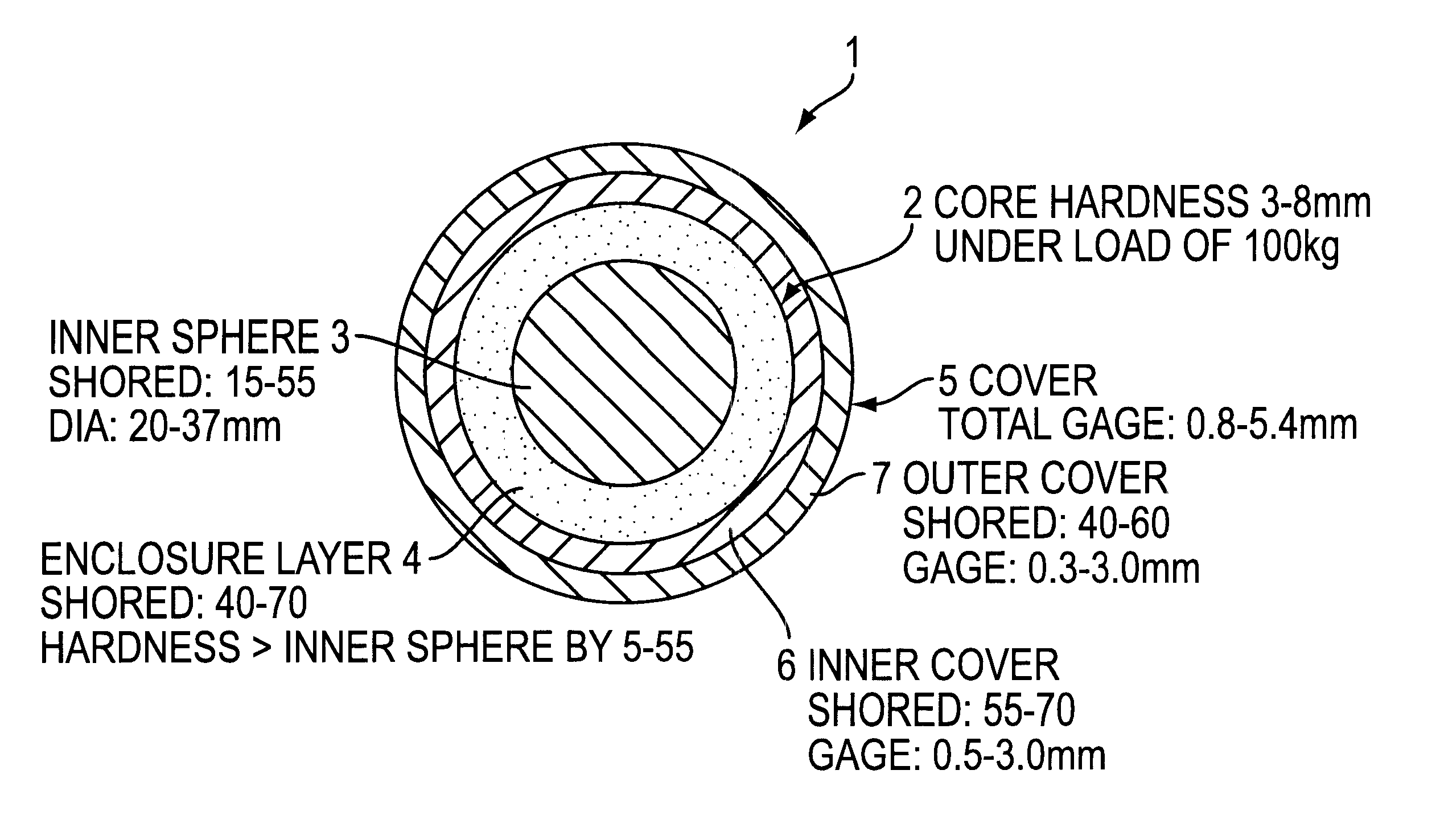

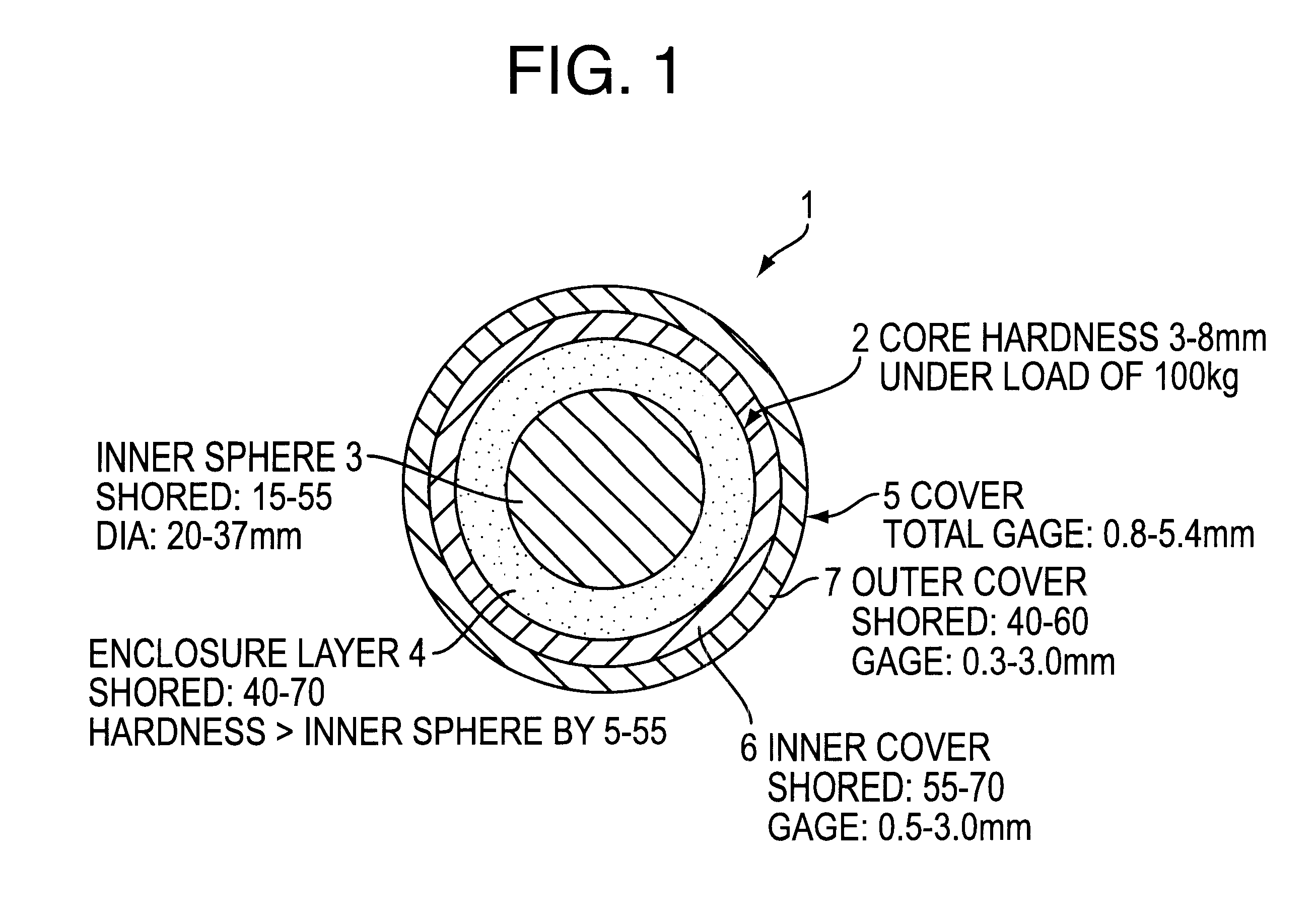

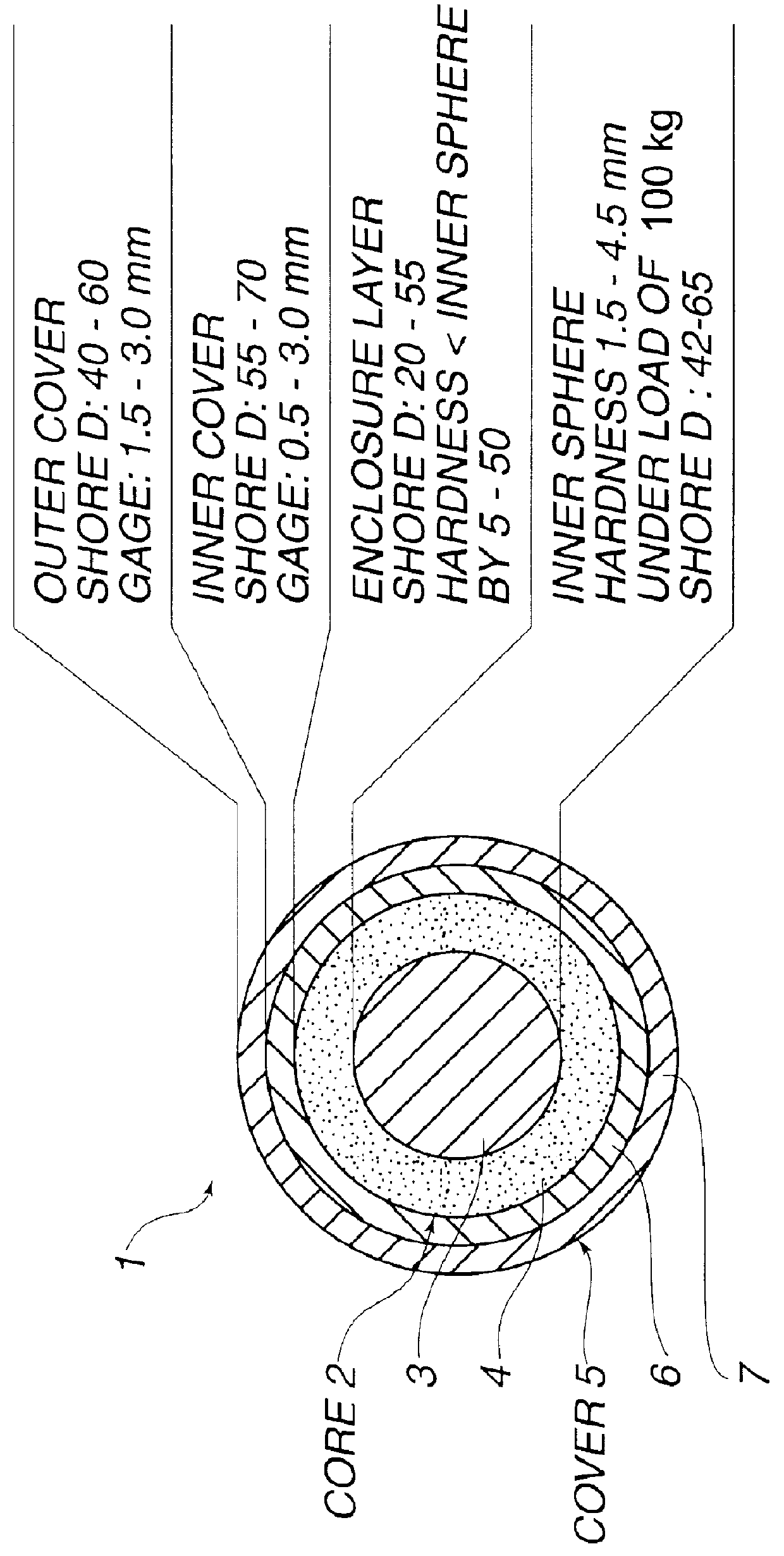

Multi-piece solid golf ball

InactiveUS6468169B1Improve approachSoft the hitting feel upon approach shotsGolf ballsSolid ballsDistortionShore

Owner:BRIDGESTONE SPORTS

Multi-piece solid golf ball

Owner:BRIDGESTONE SPORTS

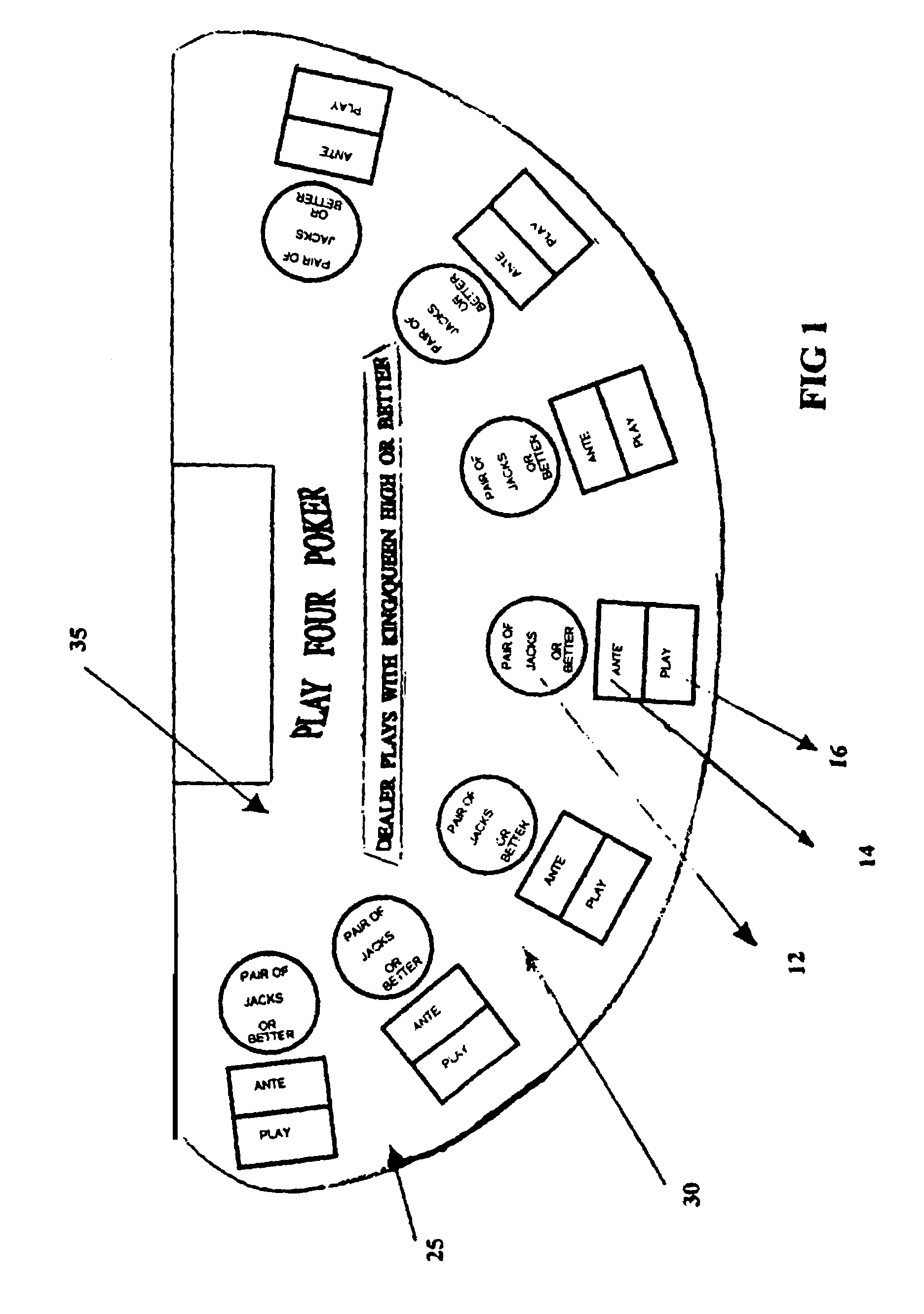

Play four poker

Owner:BALLY GAMING INC

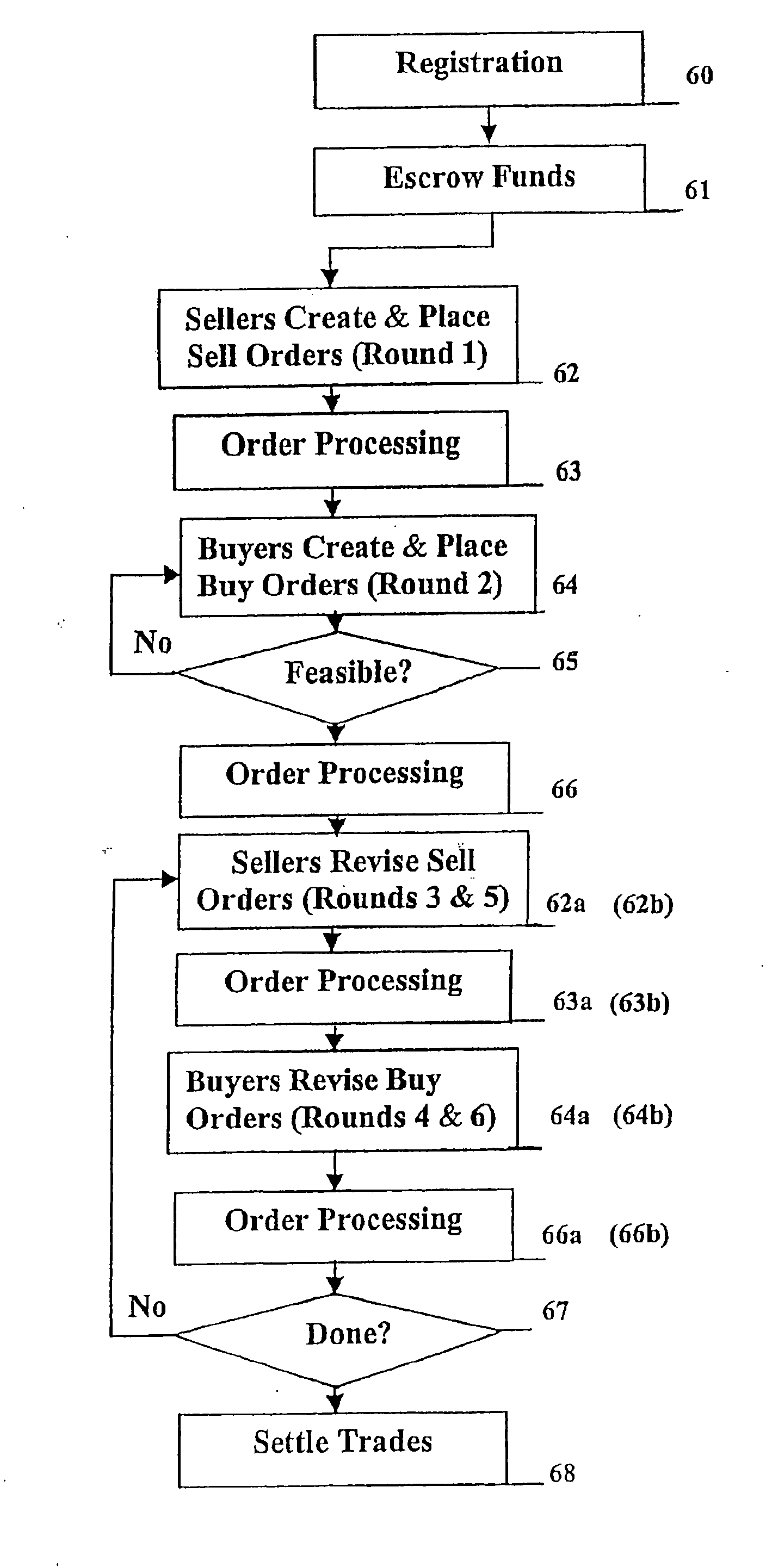

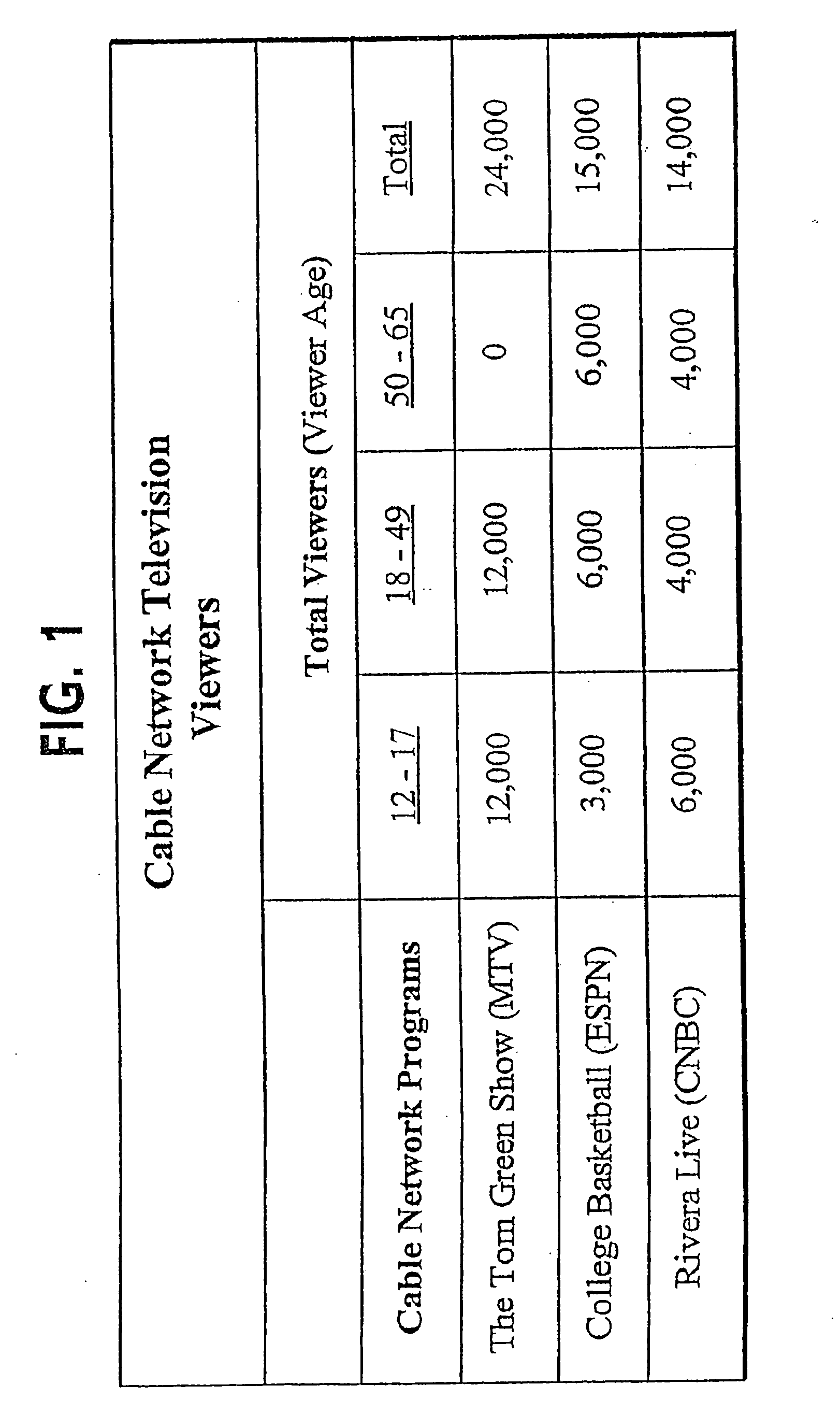

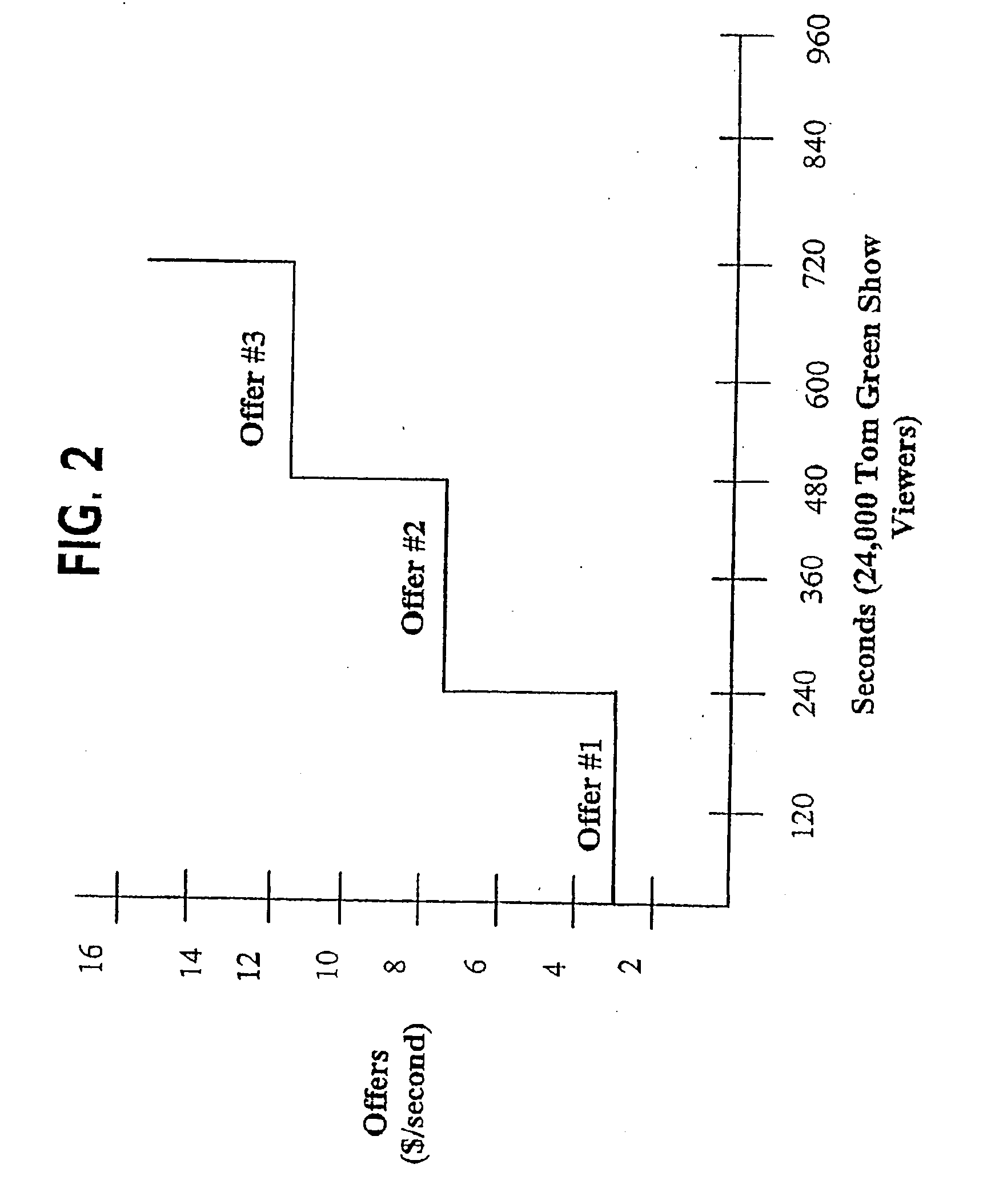

Automated exchange for the efficient assignment of audience items

InactiveUS20070288350A1Increasing amount and qualityOptimize the gains from tradeFinanceAdvertisementsLibrary science

An automated exchange system is provided which includes a smart electronic double auction for allocating audience items among prospective buyers and sellers and for calculating a set of prices for the audience items based on buyer bids from the buyers and seller offers from the sellers, including remote terminals for initiating and transmitting data including buyer bids and seller offers; and a central trade exchange system including a trading means for receiving buyer bids and seller offers from said remote terminals, simultaneously processing the buyer bids and the seller offers, identifying a set of trades in audience items between buyers and sellers which optimize gains obtained by buyers and sellers from the set of trades in audience items based on the bids and offers received by said trading means, and calculating a price for each audience item in the set of trades, and identifying rejected buyer bids and rejected seller offers.

Owner:SIENA HLDG

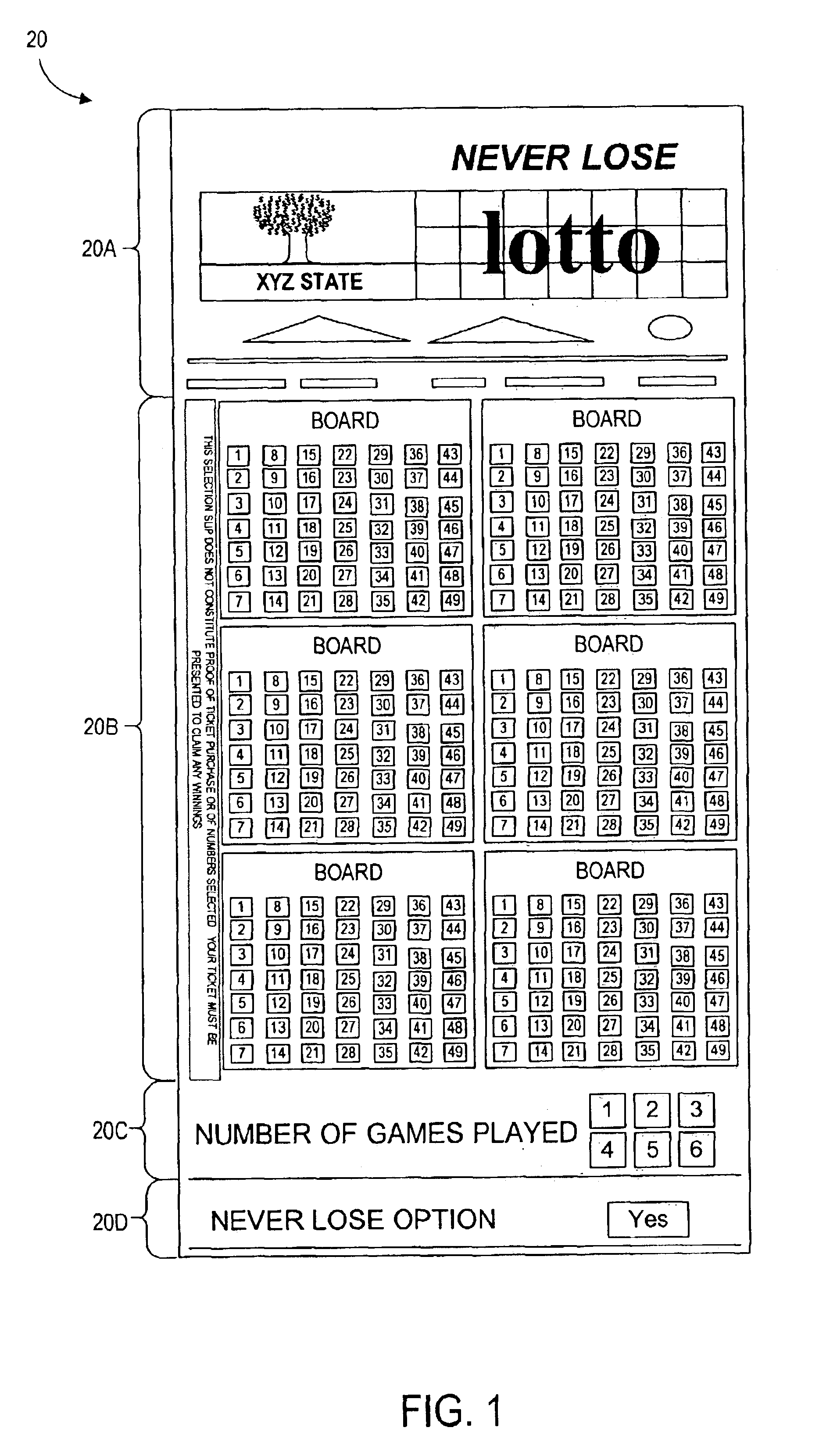

Method and apparatus for operating lotteries and for generating and processing lottery entries

InactiveUS6908382B2High returnIncrease participationLottery apparatusBoard gamesPoint of saleData bank

Owner:WALKER ASSET MANAGEMENT PARTNERSHIP +1

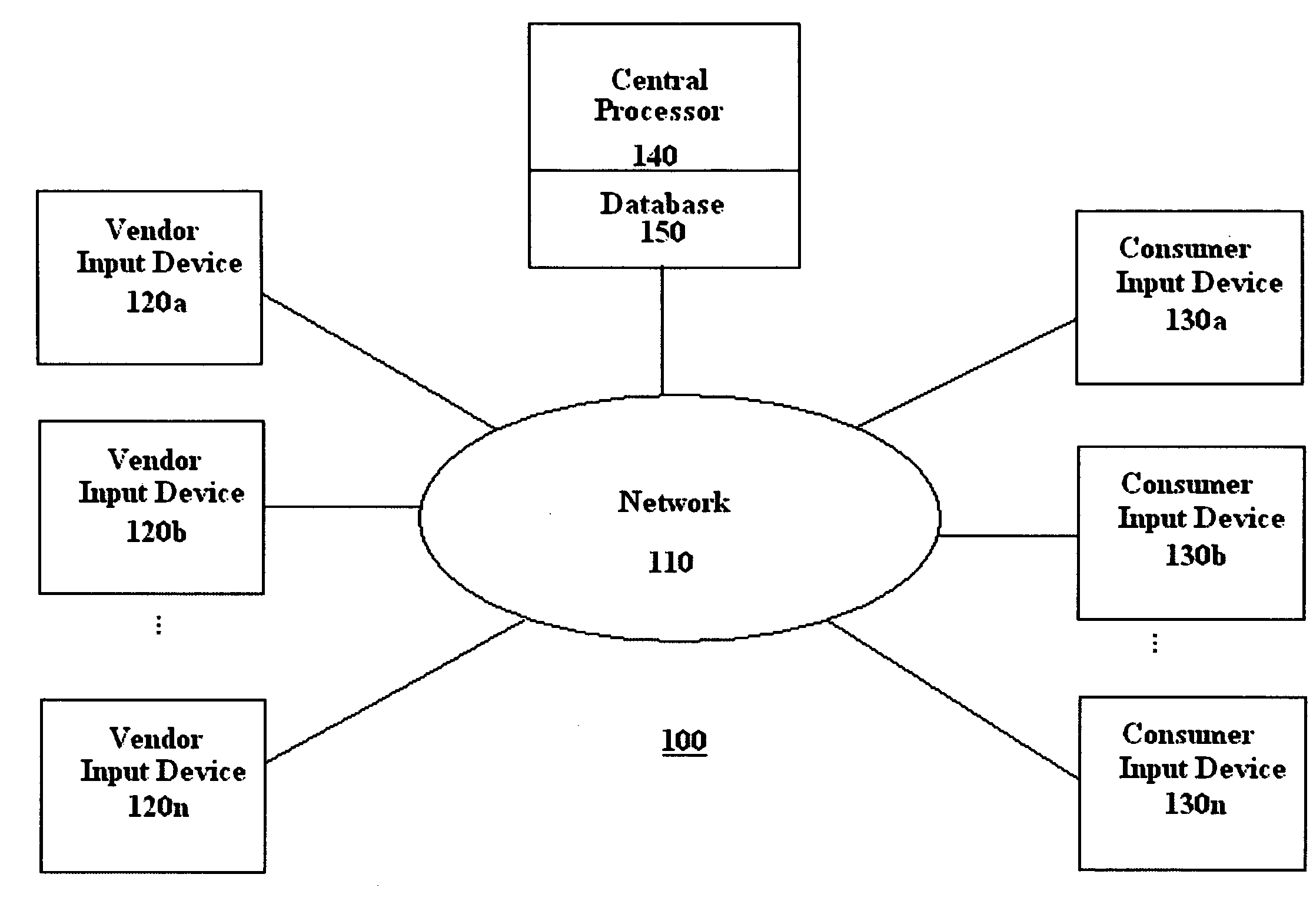

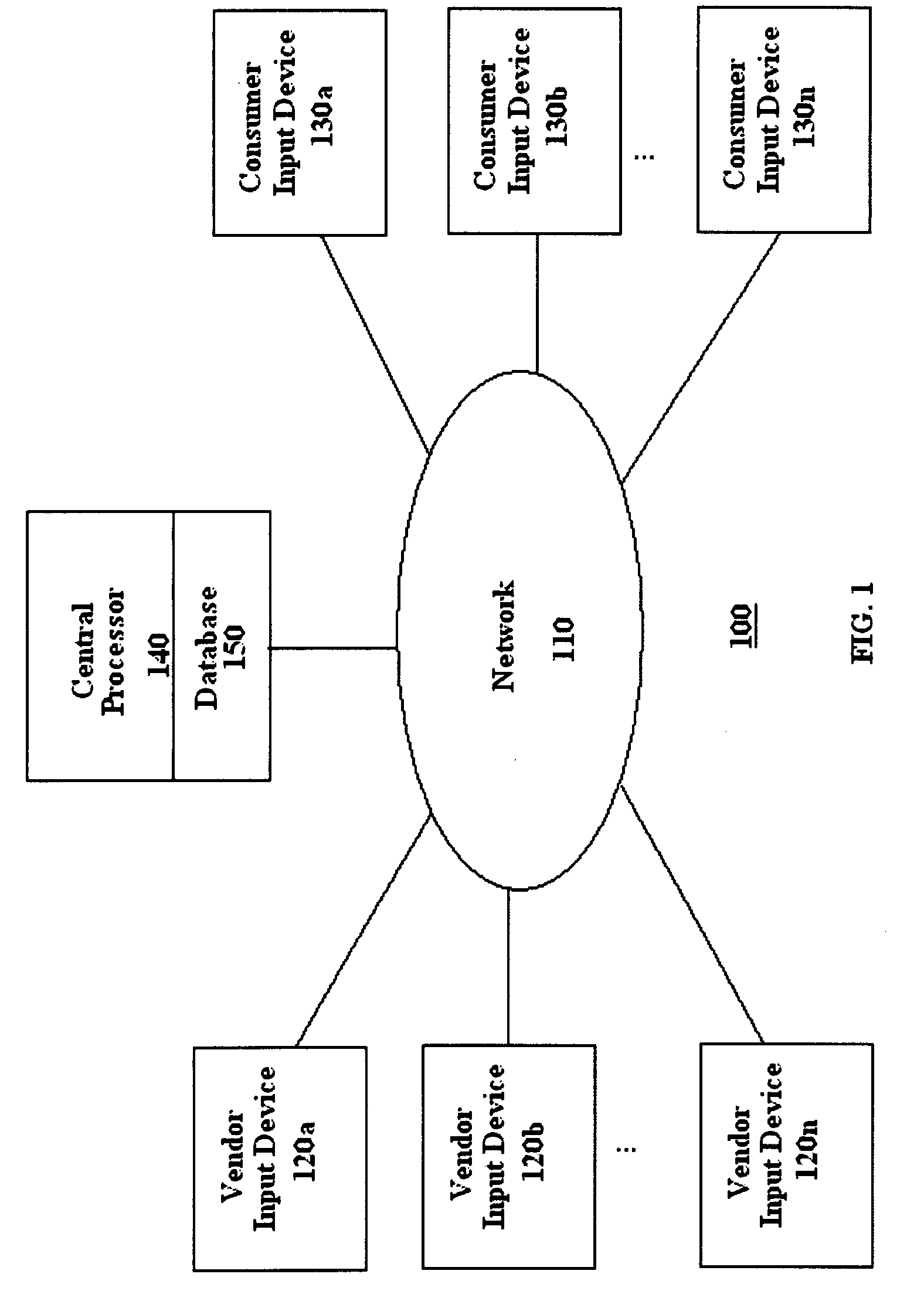

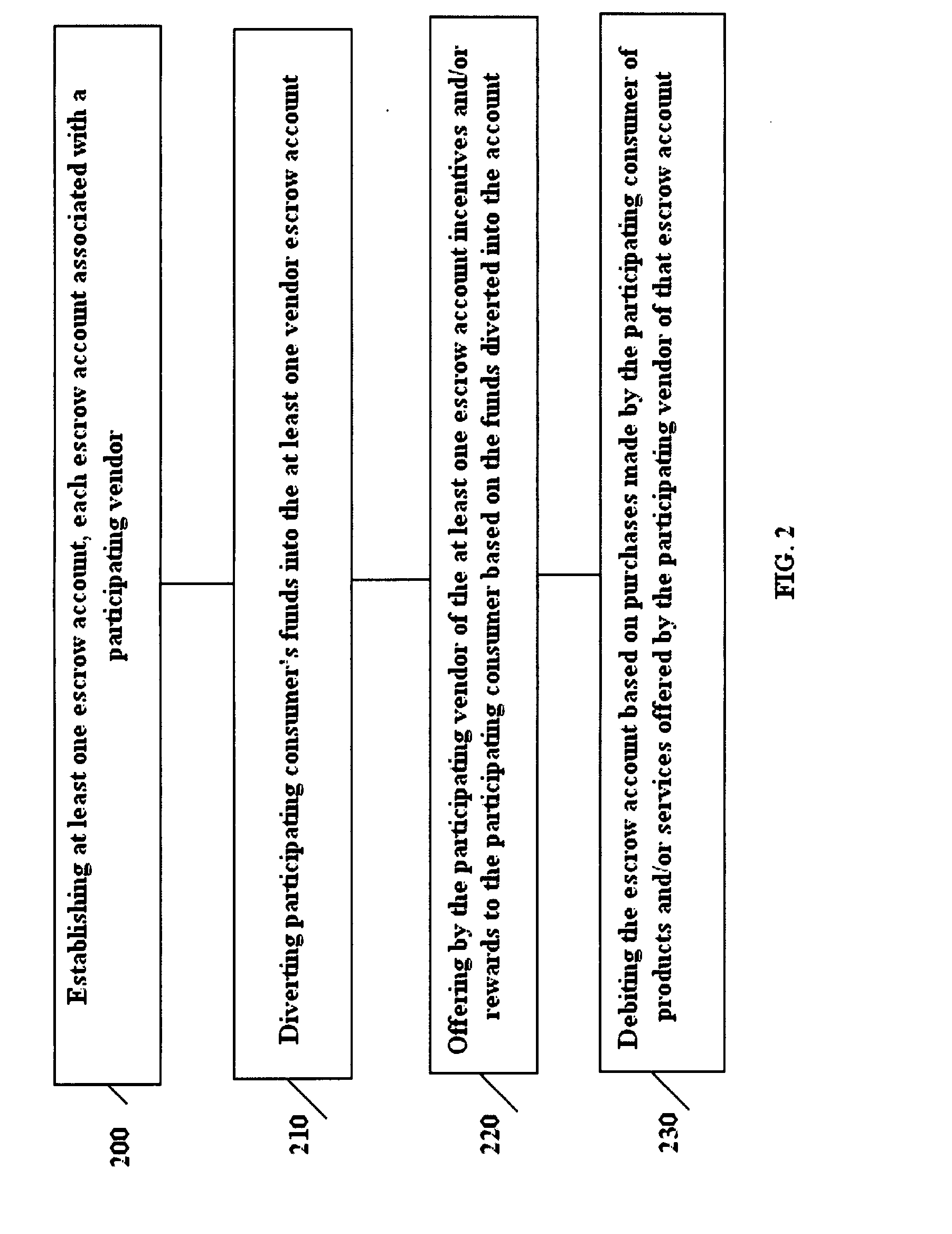

System and method for payment of consumer purchases via vendor escrow accounts

A system and method for payment by a consumer of a purchase from one of a plurality of participating vendors. Each product or service for purchase is classified by a central office into a unique class. A single vendor is permitted for each class of product or service thereby guaranteeing a maximum return of investment. The consumer establishes a vendor escrow account, wherein each vendor escrow accounts is associated with a specific participating vendor. In advance of the purchase, a predetermined amount of funds, as specified by the consumer, is diverted from their paycheck into the vendor escrow account and prohibited thereafter from withdrawal by the consumer. Appropriate funds are debited from the vendor escrow account in payment for the purchase made by the consumer from the associated participating vendor.

Owner:HALL ARTHUR W

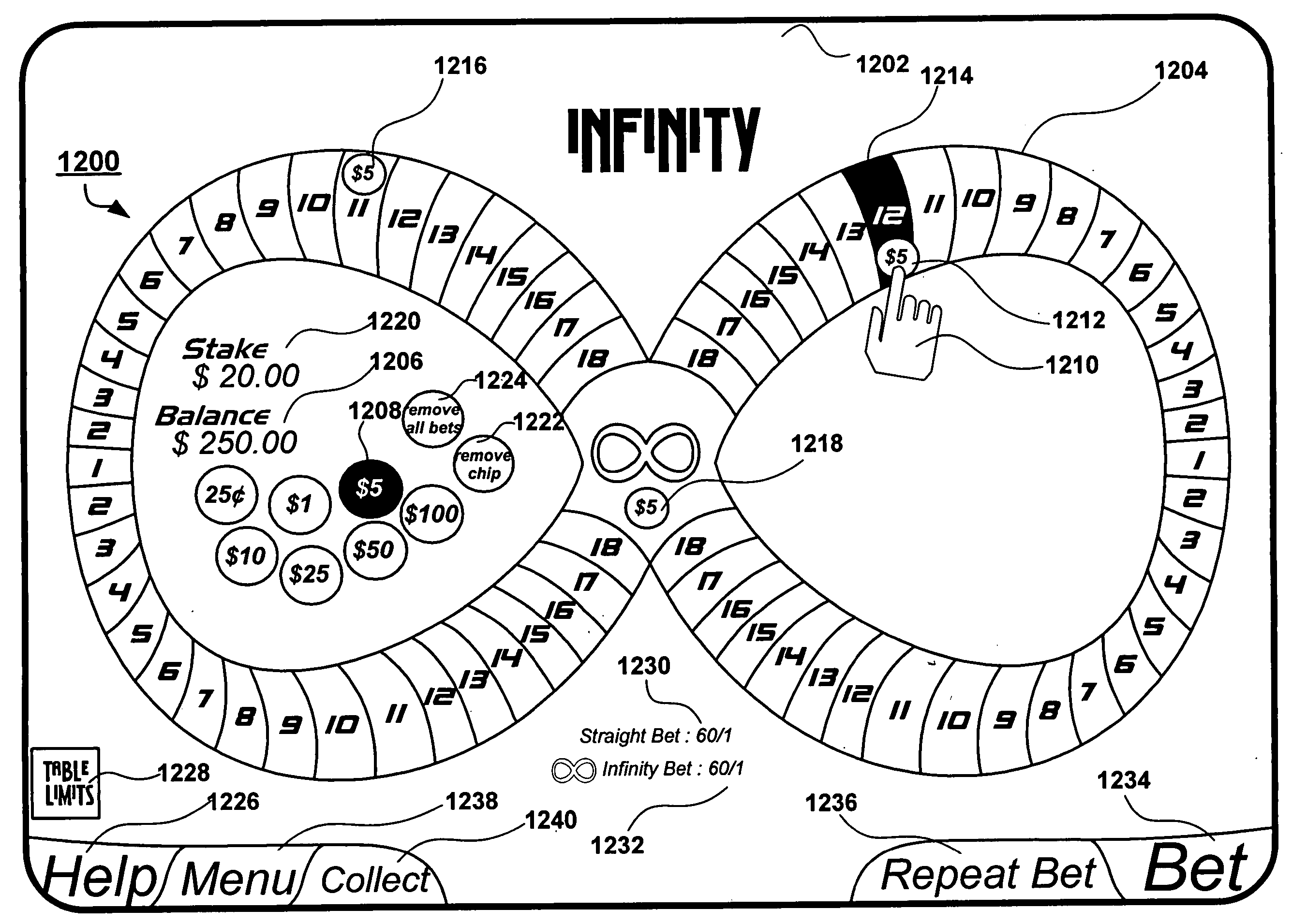

Electronic game

ActiveUS20050245307A1High returnApparatus for meter-controlled dispensingVideo gamesAnimationSelection criterion

An electronic game features captivating animations and rich selection criteria while offering the simplicity that makes the popularity of legacy games such as roulette, wheel of fortune and multi-line fruit machines casino games. One implementation of the present electronic game is configured as a 2D game tailored for slot machines. Solid 3D variants of the game extending beyond the established video slot machine form-factor are also described.

Owner:IGT

Using accounting data based indexing to create a portfolio of financial objects

A system, method and computer program product creates an index based on accounting based data, as well as a portfolio of financial objects based on the index where the portfolio is weighted according to accounting based data. A passive investment system may be based on indices created from various metrics. The indexes may be built with metrics other than market capitalization weighting, price weighting or equal weighting. Non-financial metrics may also be used to build indexes to create passive investment systems. Additionally, a combination of financial non-market capitalization metrics may be used along with non-financial metrics to create passive investment systems. Once the index is built, it may be used as a basis to purchase securities for a portfolio. Specifically excluded are widely-used capitalization-weighted indexes and price-weighted indexes, in which the price of a security contributes in a substantial way to the calculation of the weight of that security in the index or the portfolio, and equal weighting weighted indexes. Valuation indifferent indexes avoid overexposure to overvalued securities and underexposure to undervalued securities, as compared with conventional capitalization-weighted and price-weighted.

Owner:RES AFFILIATES LLC

System and method for providing an airline variable routed capacity management system

InactiveUS20050216317A1Maximize returnIncrease costReservationsSpecial data processing applicationsCapacity managementManagement system

A system and method for providing an airline variable routed capacity management system. With the system and method, a user, at time of booking, identifies only the departure and arrival airports, the dates of departure and return flights, and the travel window, i.e. the amount of travel time the user is willing to endure to travel between the departure and arrival airports, or vice versa. At time of booking, there is no blocking of travel lanes since there is no reservation of seat assignments or flights but only the guarantee that the airline will provide some flight itinerary between the departure and arrival airports that meets the travel window on the departure and return dates. The particular flights or seat assignments are not identified and are not reserved. At some time prior to the departure date, the user may again access the system of the present invention to obtain a listing of flight itineraries that meet the travel window on the dates and between the cities identified by user at booking. Based on the listing of possible flight itineraries, a user may select one of the flight itineraries and then obtain their seat and flight assignments based on the flight itinerary selected.

Owner:IBM CORP

Customer energy consumption segmentation using time-series data

InactiveUS20150161233A1Avoid problemsImprove coordinationDigital data processing detailsRelational databasesSmart meterEnergy consumption

Utility customer segmenting according to consumption lifestyle features is performed by collecting from smart meter sensors time-series utility consumption data from individual utility customers, standardizing the consumption data by dividing the time-series data into daily consumption profiles, generating a consumption profile dictionary from the standardized data, encoding the standardized data using the dictionary, extracting consumption lifestyle features of the utility customers from the encoded data, and segmenting the customers based on the extracted features by clustering.

Owner:THE BOARD OF TRUSTEES OF THE LELAND STANFORD JUNIOR UNIV

Preparation method by using Chinese medicine residue as cultivation material of edible mushroom pleurotus ostreatus

The invention relates to a preparation method by using Chinese medicine residue as a cultivation material of edible mushroom pleurotus ostreatus, which uses the Chinese medicine residue, banana peels, bran, sawdust and lime as raw materials, and is prepared by crushing, insolating, proportioning the materials and sterilizing; specific steps are as follows: respectively crushing the banana peels, the bran and the sawdust into granules; placing the bran, the sawdust and the Chinese medicine residue outdoors to expose to the sun for sterilizing and dewatering; mixing the insolated bran, sawdust and Chinese medicine residue with the crushed banana peels, and then adding water and mixing with the lime sufficiently and uniformly, sterilizing at high temperature to obtain the cultivation material. The preparation method has advantages as follows: the waste Chinese medicine residue from medicine factories and the banana peels are used for culturing high-quality edible mushrooms, the waste is changed into things of value, the production cost is saved, the cultivation period is shortened, the yield is increased, the mushroom contamination rate is reduced with no poison or harm, the eating is safe, the waste treatment difficulty is resolved without causing pollution, both the environmental purpose and the economic purpose are achieved, the operation is simple, and the industrial production is easy to achieve.

Owner:AOWEI TIANJIN ENVIRONMENTAL PROTECTION TECH

Using accounting data based indexing to create a portfolio of financial objects

A system, method and computer program product creates an index based on accounting based data, as well as a portfolio of financial objects based on the index where the portfolio is weighted according to accounting based data. A passive investment system may be based on indices created from various metrics. The indexes may be built with metrics other than market capitalization weighting, price weighting or equal weighting. Non-financial metrics may also be used to build indexes to create passive investment systems. Additionally, a combination of financial non-market capitalization metrics may be used along with non-financial metrics to create passive investment systems. Once the index is built, it may be used as a basis to purchase securities for a portfolio. Specifically excluded are widely-used capitalization-weighted indexes and price-weighted indexes, in which the price of a security contributes in a substantial way to the calculation of the weight of that security in the index or the portfolio, and equal weighting weighted indexes. Valuation indifferent indexes avoid overexposure to overvalued securities and underexposure to undervalued securities, as compared with conventional capitalization-weighted and price-weighted.

Owner:RES AFFILIATES LLC

Systems and methods for asset based lending (ABL) valuation and pricing

An automated asset based lending (ABL) system that integrates supplier receivables data, allowing financial institutions optimally to value and price lending against those receivables, thus enabling financial institutions to offer suppliers a maximum borrowing base with minimum risk and highest return to the financial institution, further enabling the financial institution to conduct business in multiple currencies, time zones and countries using a computer based ABL process. In an asset based lending system having a client and at least one financial institution, a method for valuing and pricing client's receivables, the method comprising, downloading accounts receivable information from the client, the accounts receivable information having a specified currency, calculating a borrowing base for the client via utilizing debtor risk ratings, pricing profiles, valuation profiles and pricing tiers, and applying fees and interest as specified in the pricing profile associated with the valuation profile.

Owner:PRIMEREVENUE

Using accounting data based indexing to create a portfolio of assets

ActiveUS7747502B2Avoiding inherent valuation biasEffectively limit riskFinanceObject basedCombined use

Owner:RES AFFILIATES LLC

Automatic classification of credit card customers

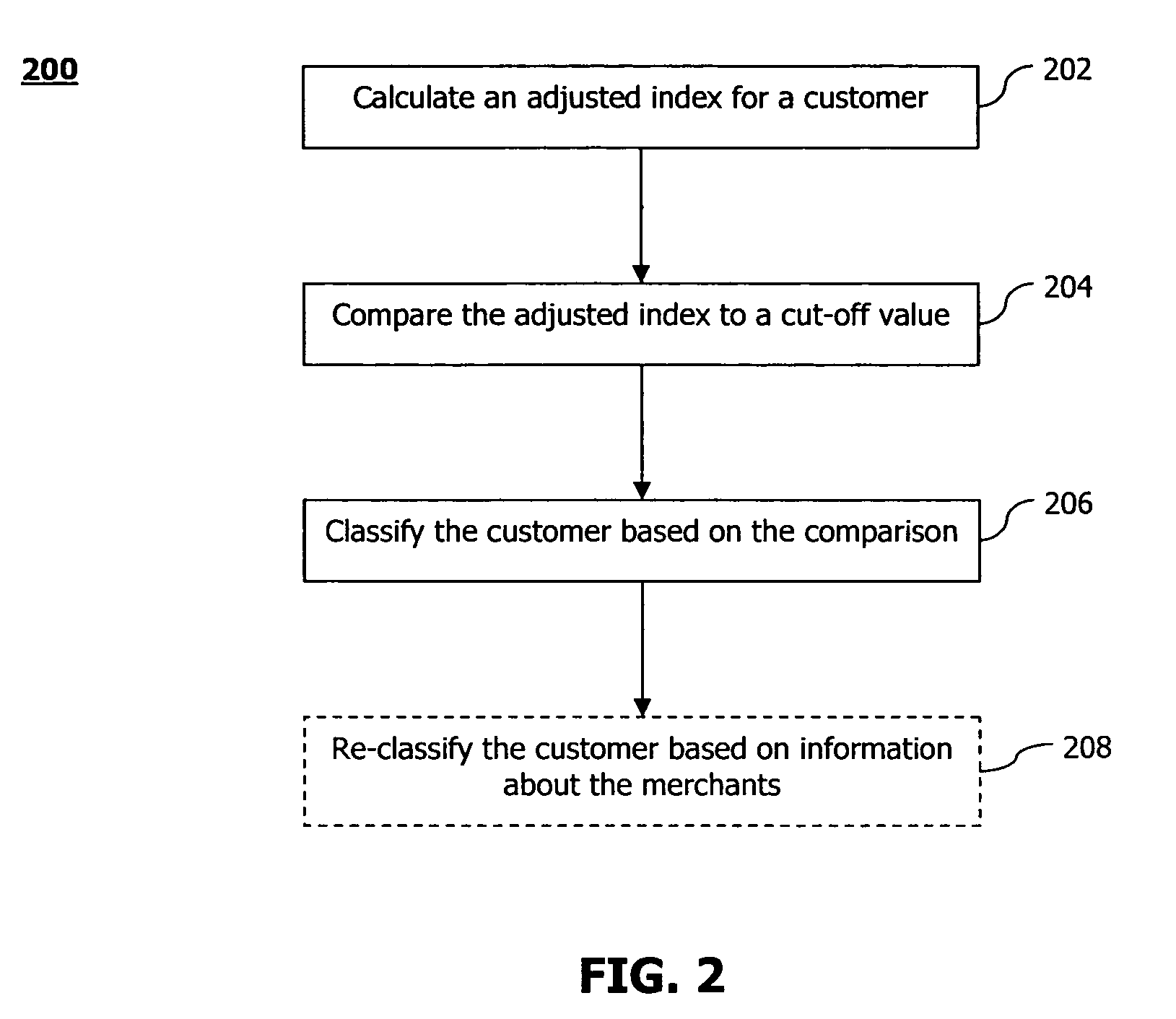

ActiveUS7690564B2Easy to useSignificant positive effectMarket predictionsFinanceCredit cardFinancial transaction

According to embodiments of the present invention there is provided a computer-based method and a computer program product for automatically sorting customers who make purchases from merchants using a credit card. The computer-based method includes the following steps. An adjusted index is calculated for a customer based on an amount of money the customer spent across merchants during a time period. The adjusted index is compared to a cut-off value. The customer is classified based on the comparison of the adjusted index to the cut-off value. In an embodiment, the method also includes re-classifying the customer based on at least one of (i) information about the merchants, or (ii) a number of transactions in a predetermined industry.

Owner:AMERICAN EXPRESS TRAVEL RELATED SERVICES CO INC

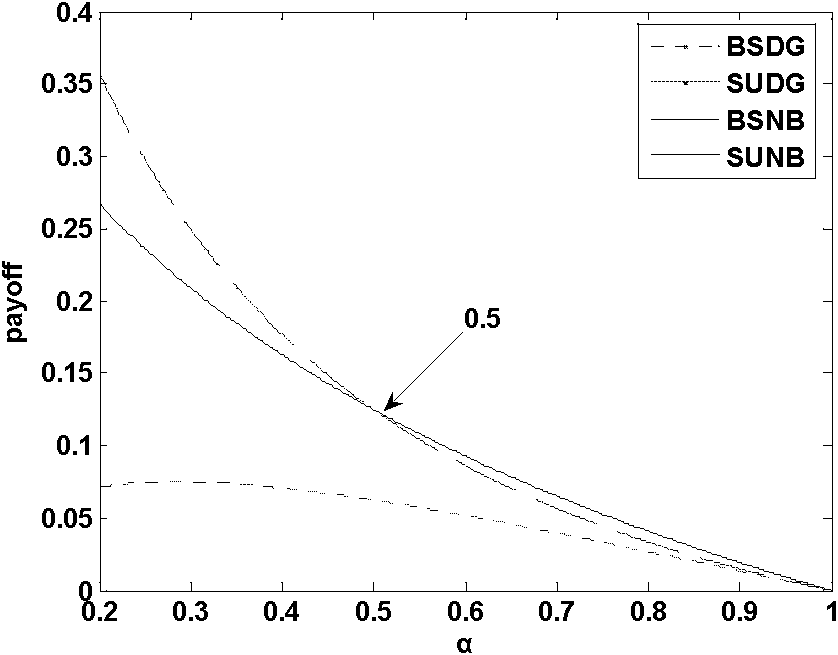

Game type selection-based method for realizing dynamic spectrum allocation

The invention relates to a game type selection-based method for realizing dynamic spectrum allocation. With the development of the wireless communication technology, the traditional fixed spectrum allocation mode which leads to the waste of resources and has low spectrum utilization rate, has become the key factor of limiting the further development of the wireless communication network. The cognitive radio-based dynamic spectrum allocation technology is considered as a key technology for effectively solving the problem. In the method of the invention, by comparing the perfect dynamic game with the return of Nash Bargaining, the cognitive base station and the secondary user can separately choose an optimal strategy flexibly and fairly, namely an optimal spectrum quoted unit price and a spectrum purchase quantity. Meanwhile, in order to realize the selection operations of the both sides, a simple spectrum access procedure is designed to be compatible with the traditional mobile call access procedure. By adopting the invention, the returns of the cognitive base station and the secondary user can be effectively increased and the spectrum utilization can be promoted.

Owner:XI AN JIAOTONG UNIV

Using accounting data based indexing to create a low volatility portfolio of financial objects

A system, method and computer program product creates an index based on accounting data, or a portfolio of financial objects based on the index where the portfolio is weighted according to accounting data. Indexes may be built with metrics other than market capitalization weighting, price weighting or equal weighting. Financial and non-financial metrics may be used to build indexes to create passive investment systems. A combination of financial non-market capitalization metrics may be used with non-financial metrics to create passive investment systems. Once built, the index may be used as a basis to purchase securities for a portfolio. Specifically excluded are widely-used capitalization-weighted and price-weighted indexes, in which price of a security contributes in a substantial way to calculation of weight of that security in the index or the portfolio, and equal weighting weighted indexes. The indexes may be constructed to minimize volatility.

Owner:RES AFFILIATES LLC

Return-driven casino game outcome generator

ActiveUS8360854B2Positively affect their destinyHigh returnApparatus for meter-controlled dispensingVideo gamesHuman–computer interactionAverage return

Owner:IGT

Sea cucumber blueberry health care wine and method for processing same

ActiveCN101584474AProtects Active NutrientsIncrease profitAlcoholic beverage preparationFood preparationBiotechnologyNutritive values

The invention provides a sea cucumber blueberry health care wine and a method for processing the same. Sea cucumber, ginseng, medlar and blueberry are taken as main raw materials, honey, a sweetening agent and Vc are taken as auxiliary raw materials, the main raw materials and the auxiliary raw materials undergo pre-treatment and liquor alcoholization to separate and extract active substances of the raw materials, and the active materials are processed by the methods of health care wine blending, filtering, sterilization and the like to prepare the sea cucumber blueberry health care wine. The sea cucumber blueberry health wine has the advantages of transparency, even liquid, rich nutrition, no fishy smell, pleasant sweetness and sourness, good nourishing effect and quick and convenient drinking. The processing method has the advantages that the activity of nutrient substances in the mixture are kept and stabilized in a liquid state, the original flavor, the taste and the color of the materials are kept, and the medicinal value, nutrient value and drinking value of the mixture of a few raw materials are improved.

Owner:辽宁阿里郎生物工程股份有限公司

Game of chance

InactiveUS20080054560A1Raise the possibilityIncrease probabilityBoard gamesCard gamesRandomizationConfusion

A game of chance involves use of a pair of dice or other randomizing device to obtain a first number set, wherein a first wager immediately wins when the first number set from the dice / device adds up to one of the numbers in a selected Numbers Group or Wagering Zone. A winning wager, or portion of the winning wager, may be parlayed to a second tier wager to determine whether the next roll of the dice / device will produce a second number set that is the same as the first number set. The Wagering Zones may be incorporated / combined with traditional casino game layouts, for example, Craps, slot-machine, Blackjack, or Roulette types of layout. In many board or table embodiments, wagers, based on speculation of what will be the first number set and subsequent number sets, are placed directly on the playing surface, with second tier wagering zones provided to prevent confusion with others' “fresh” wagers on the subsequent rolls. In computer or electronic slot-machine embodiments, the programming / memory may serve to differentiate, monitor, and display first vs. second tier wagers. The ability to bet on both grouped numbers (in a first tier wager), and on individual numbers in a Target Set, in any gaming layout or platform, will increase player enthusiasm and observer excitement. The knowledge that a player may be paid for successfully wagering on a winning Numbers Group after only one roll of the dice, helps move the game along and also adds to the excitement of the game.

Owner:PRESLEY JOSEPH R +1

Method And System For Generating An Index Of Securities

Owner:OCEAN TOMO

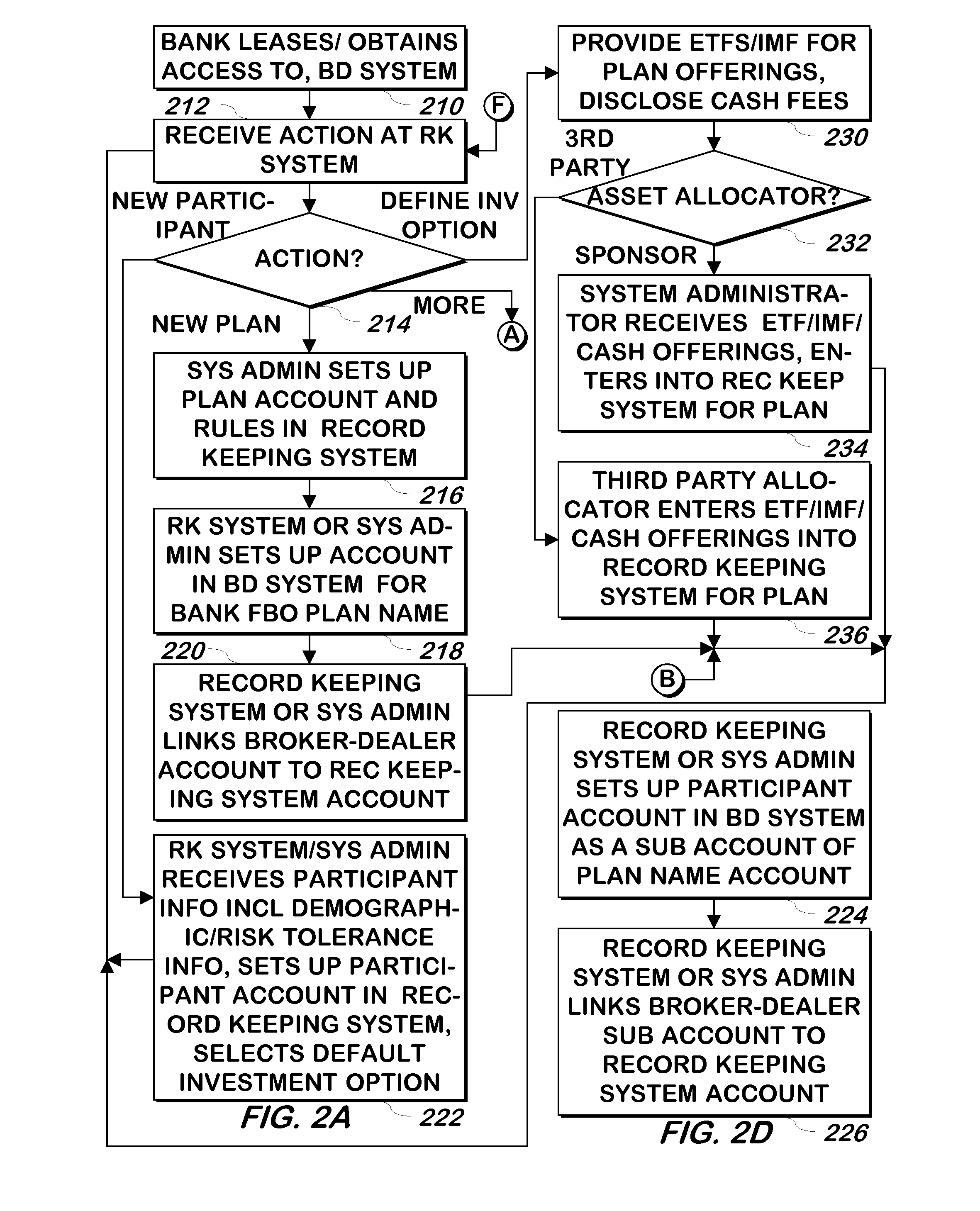

System and method for setting up and managing retirement accounts of ETFs and index mutual funds

Owner:CHARLES SCHWAB & CO INC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com