Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

1917results about How to "Accurate description" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Wireless patient monitoring systems and methods

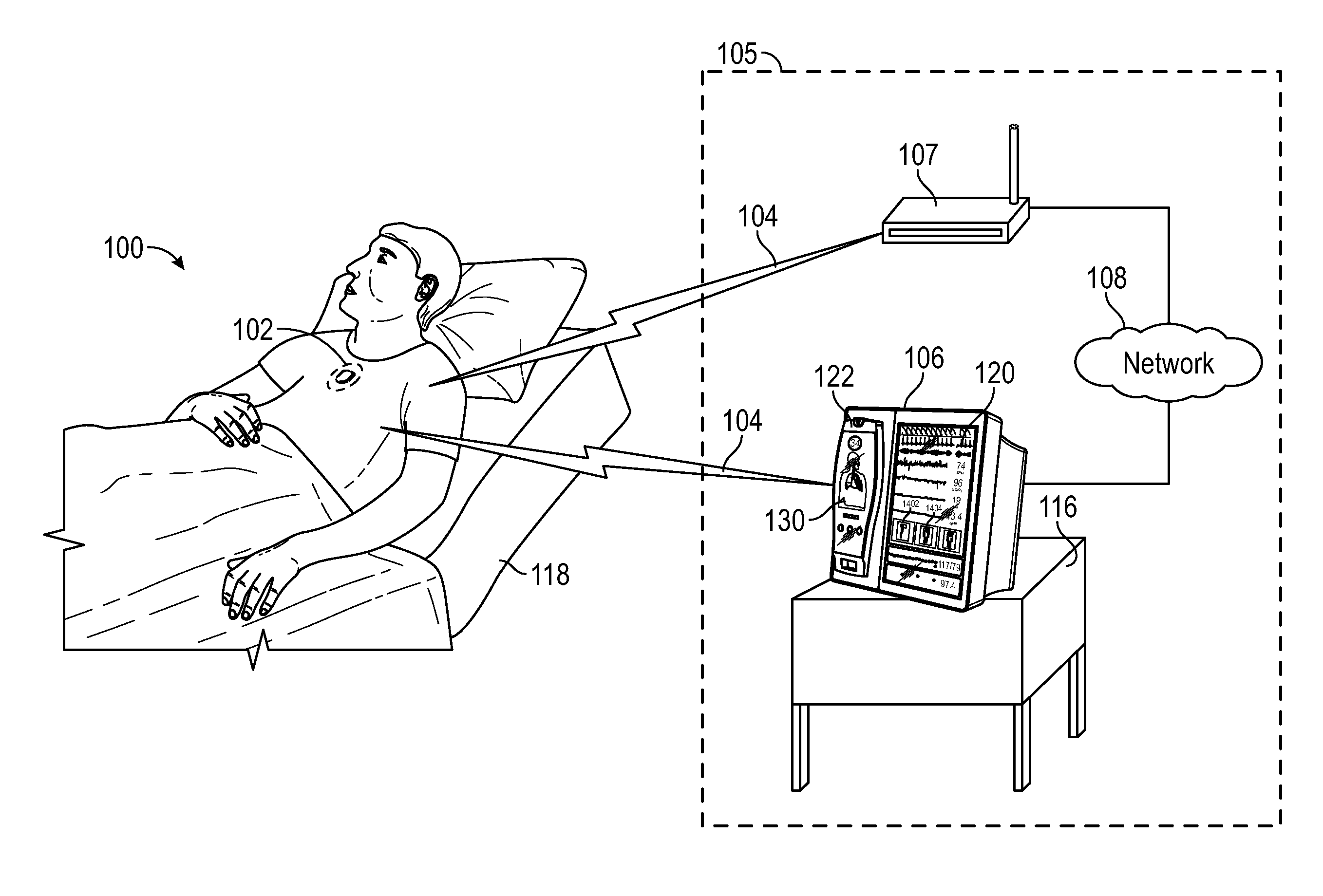

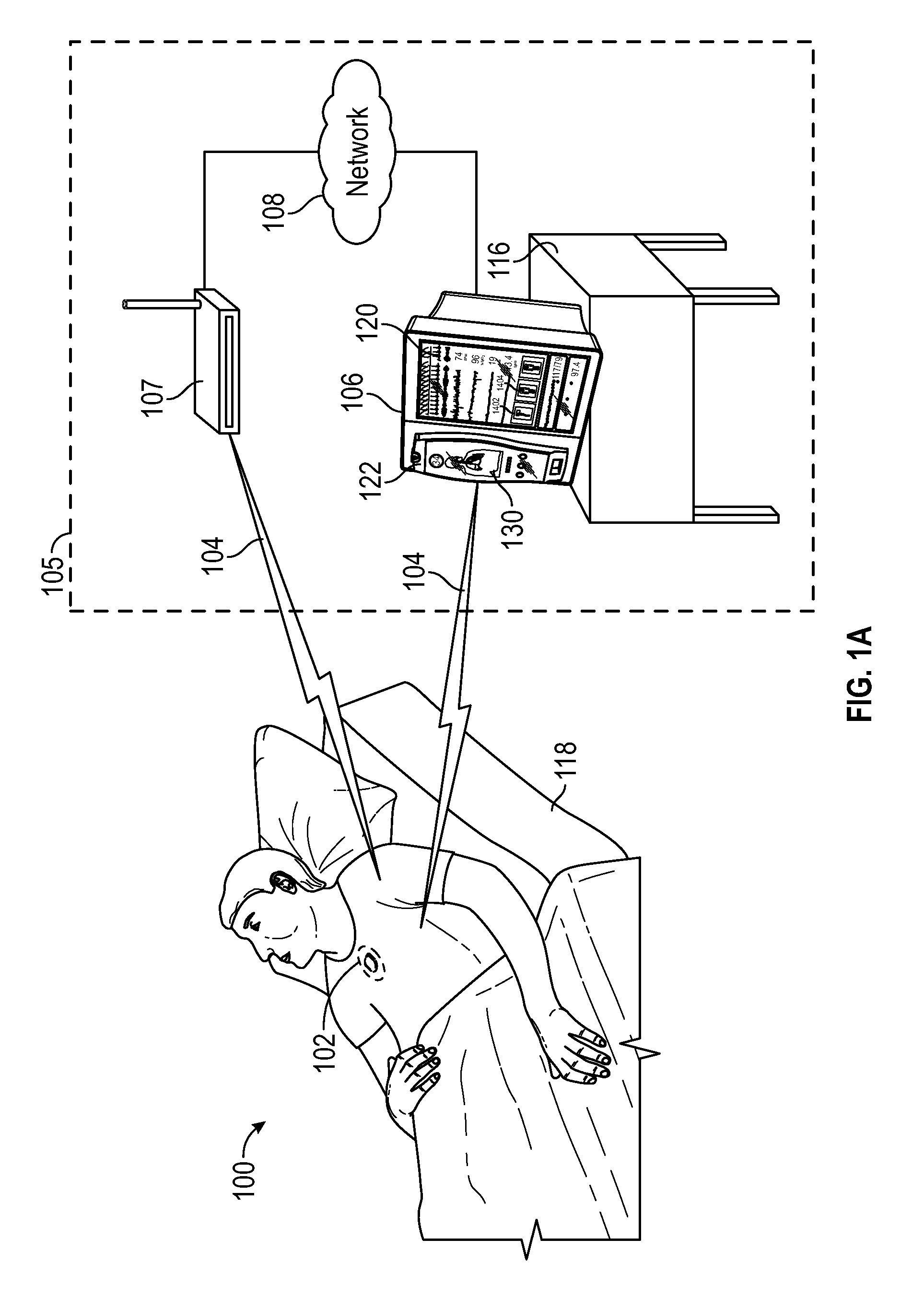

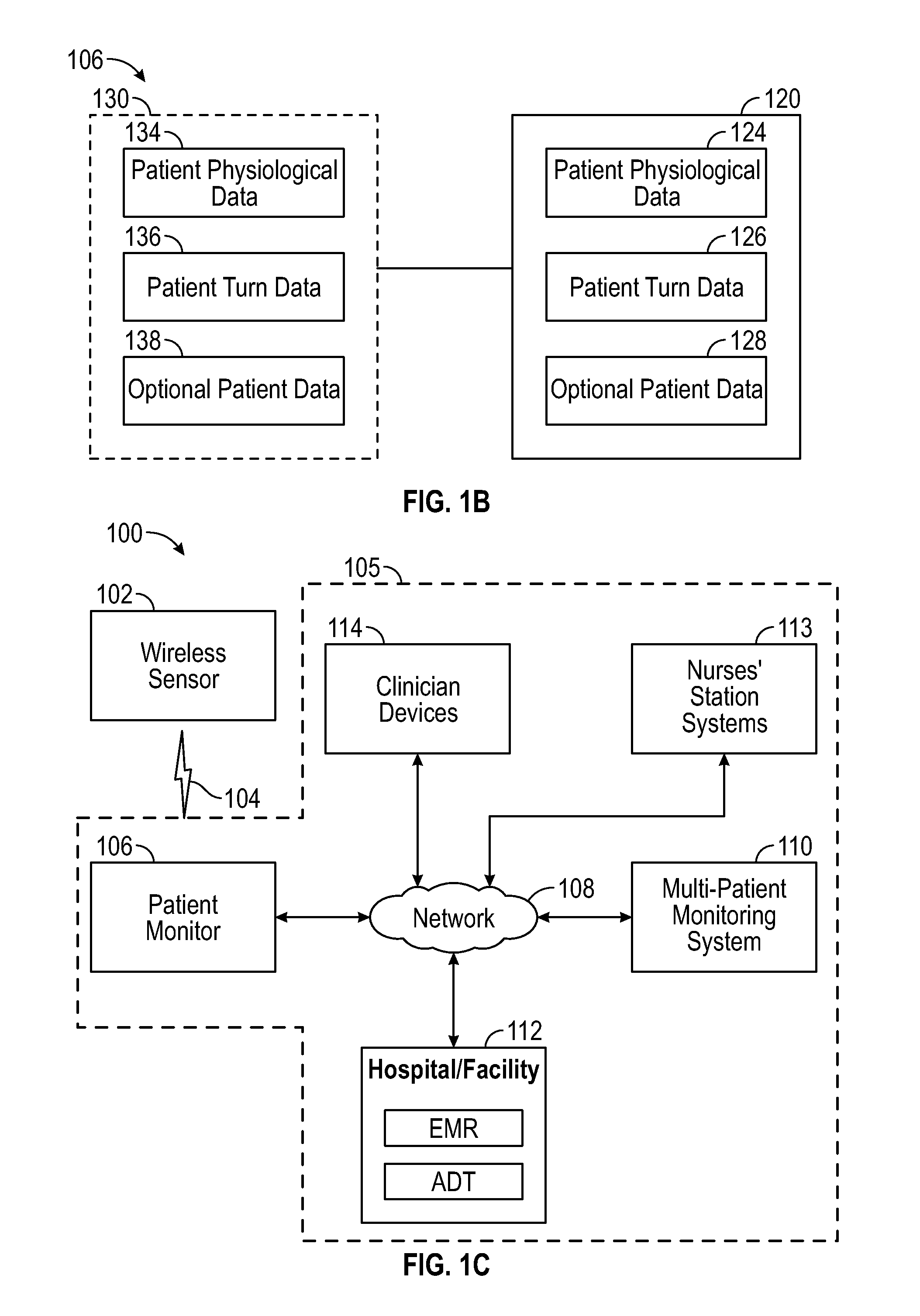

A patient monitoring system to help manage a patient that is at risk of forming one or more pressure ulcers is disclosed. The system includes a patient-worn wireless sensor that senses the patient's orientation and wirelessly transmits information indicative of the sensed orientation to a patient monitor. The patient monitor receives, stores, and processes the transmitted information. It also displays and transmits information indicative of the patient's orientation to help caregivers manage the patient's risk of formation of one or more pressure ulcers. The system can identify the present orientation of the patient and determine how long the patient has been in the present orientation. If the patient remains in an orientation beyond a predefined duration, the system can notify the patient and / or caretakers that the patient is due to be repositioned.

Owner:MASIMO CORP

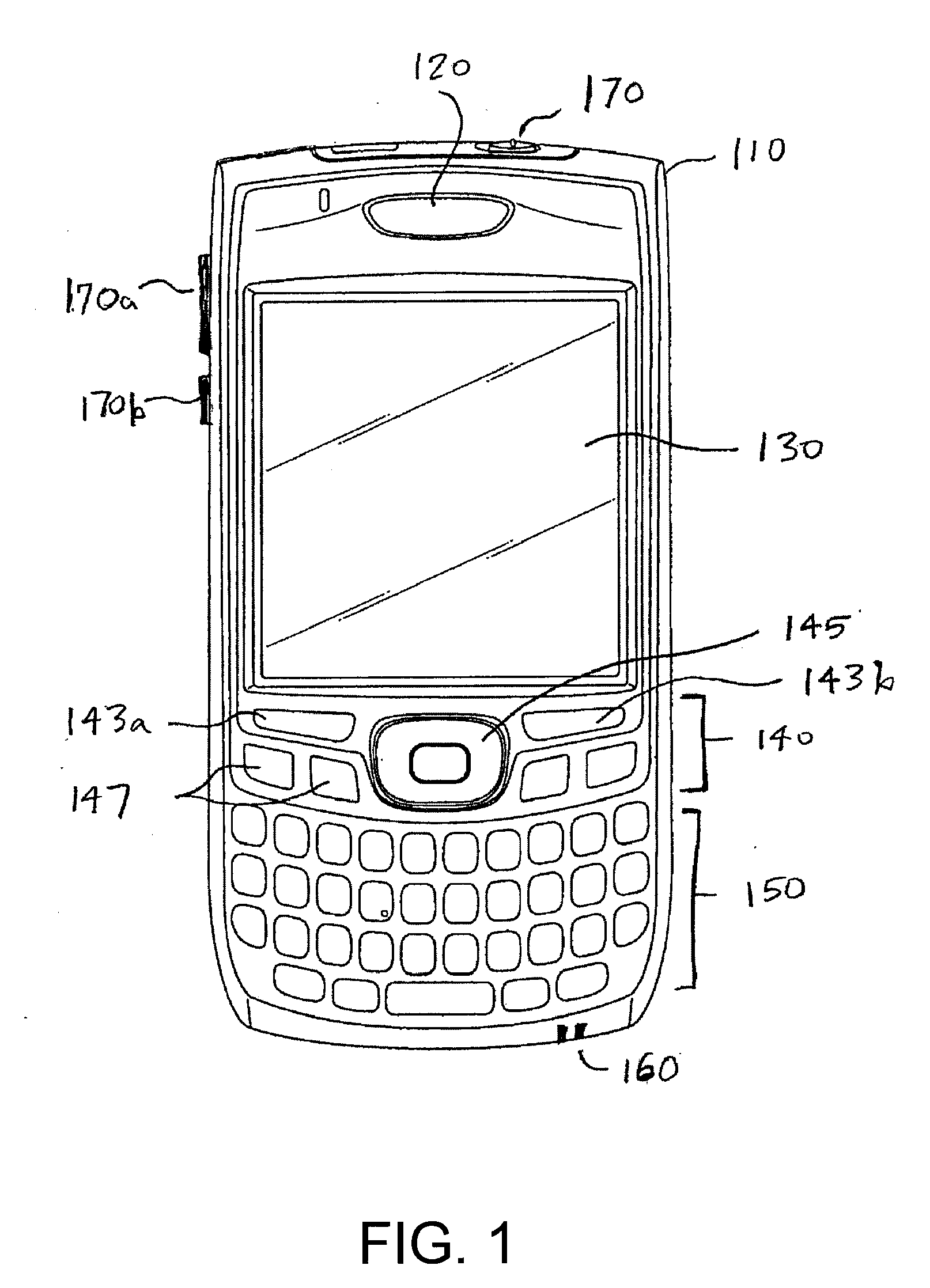

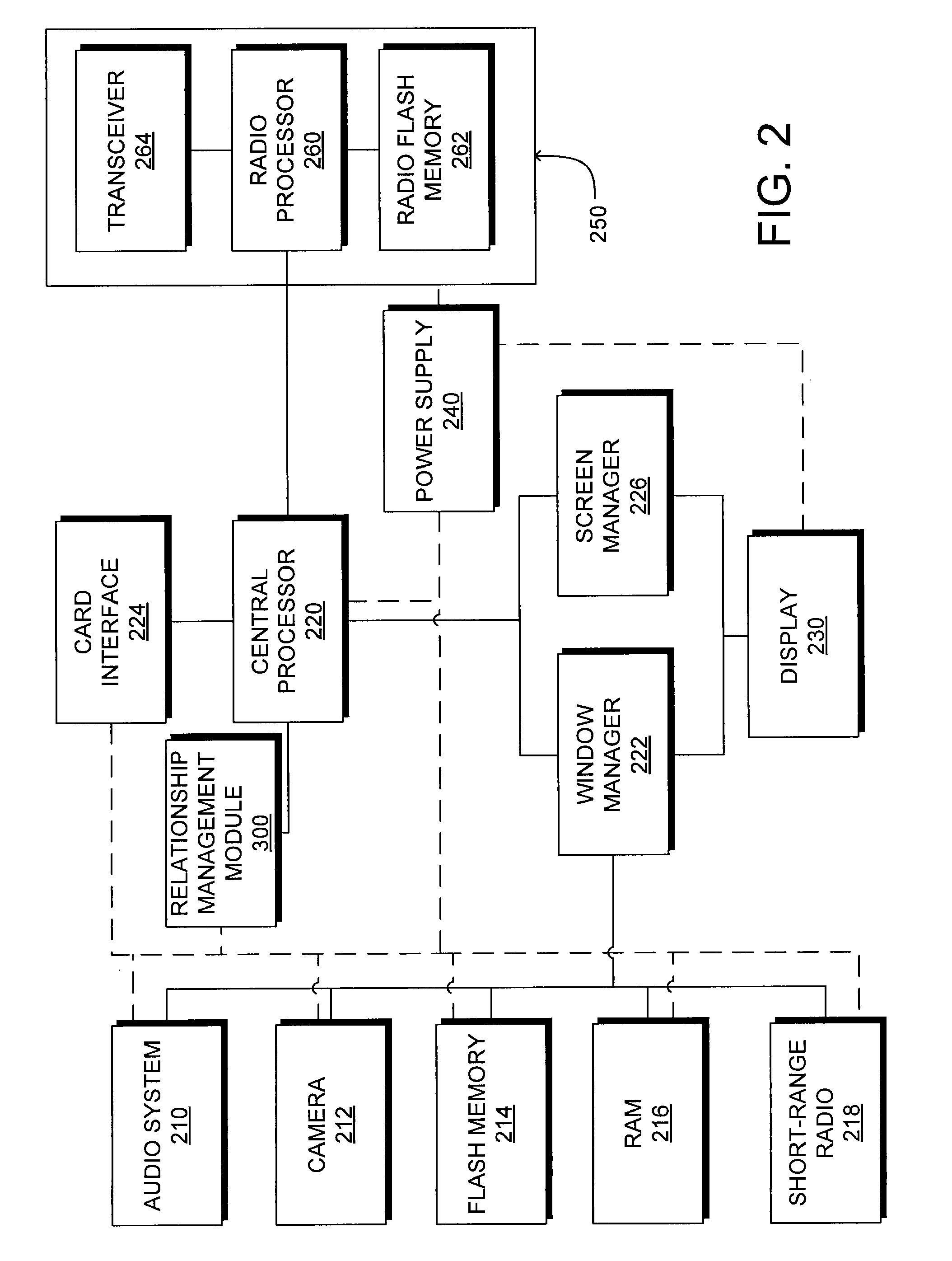

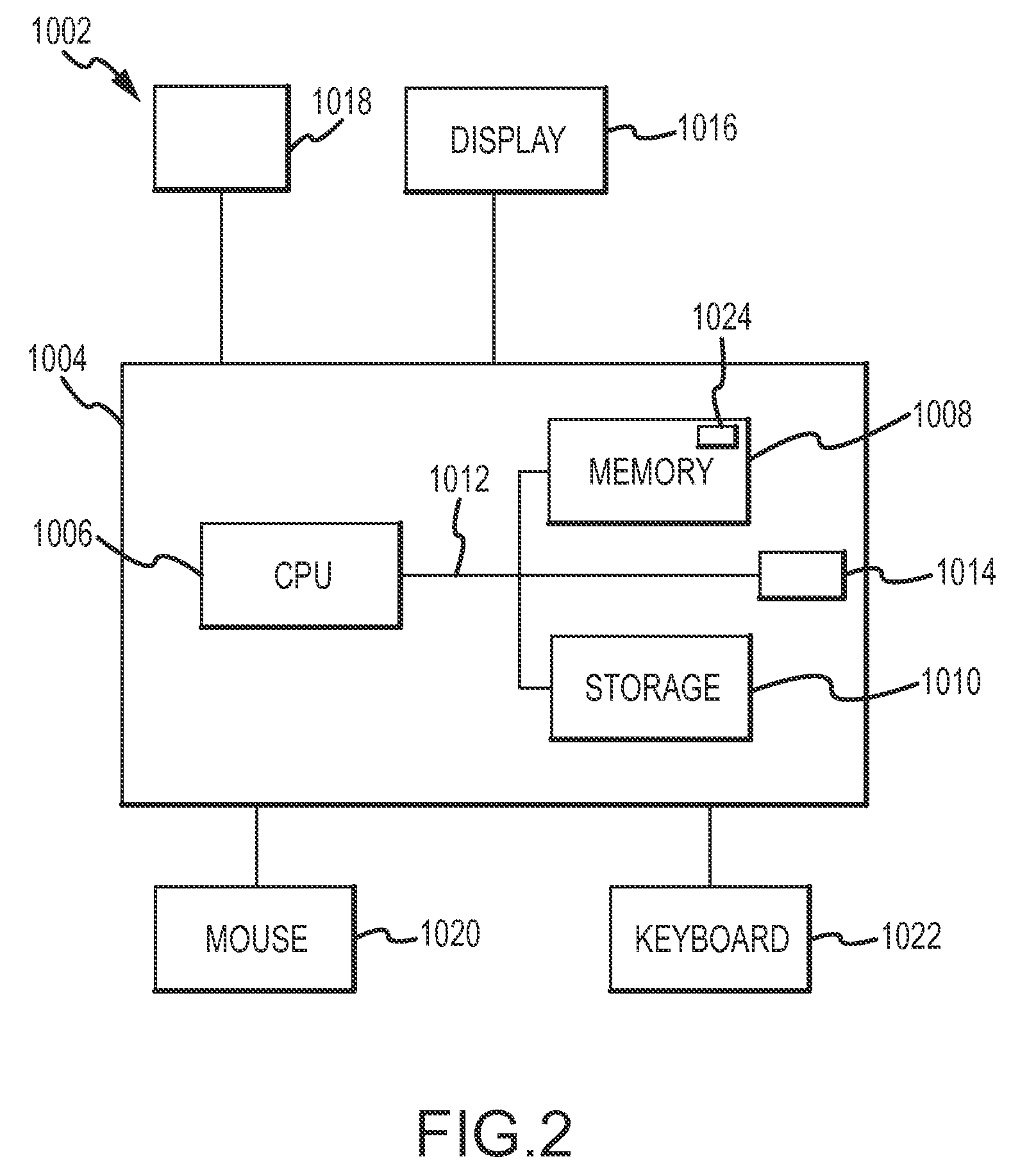

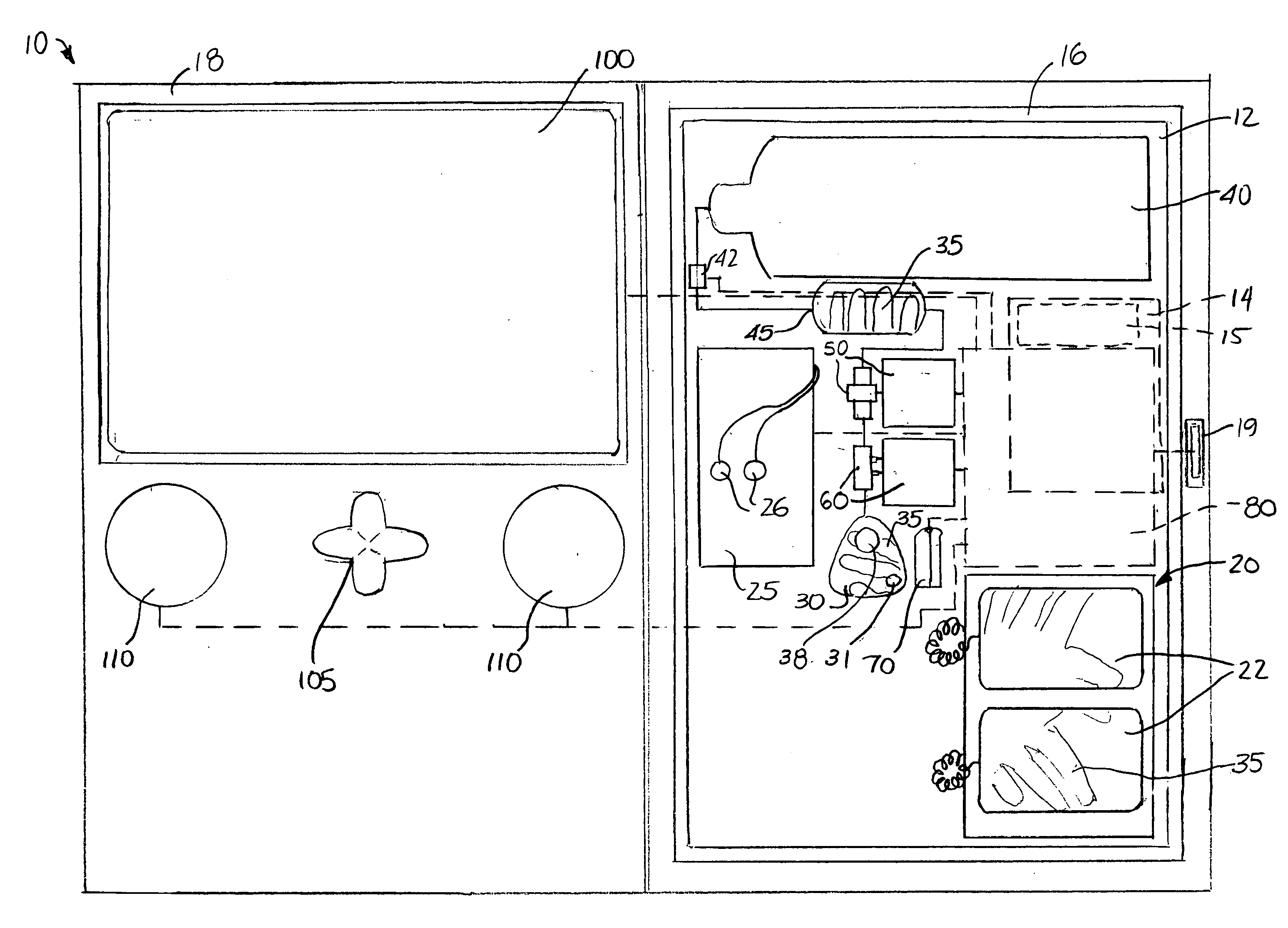

Relationship management on a mobile computing device

InactiveUS20100057643A1Accurate descriptionQuickly access and viewDigital data processing detailsSubstation equipmentValue creationCommunication device

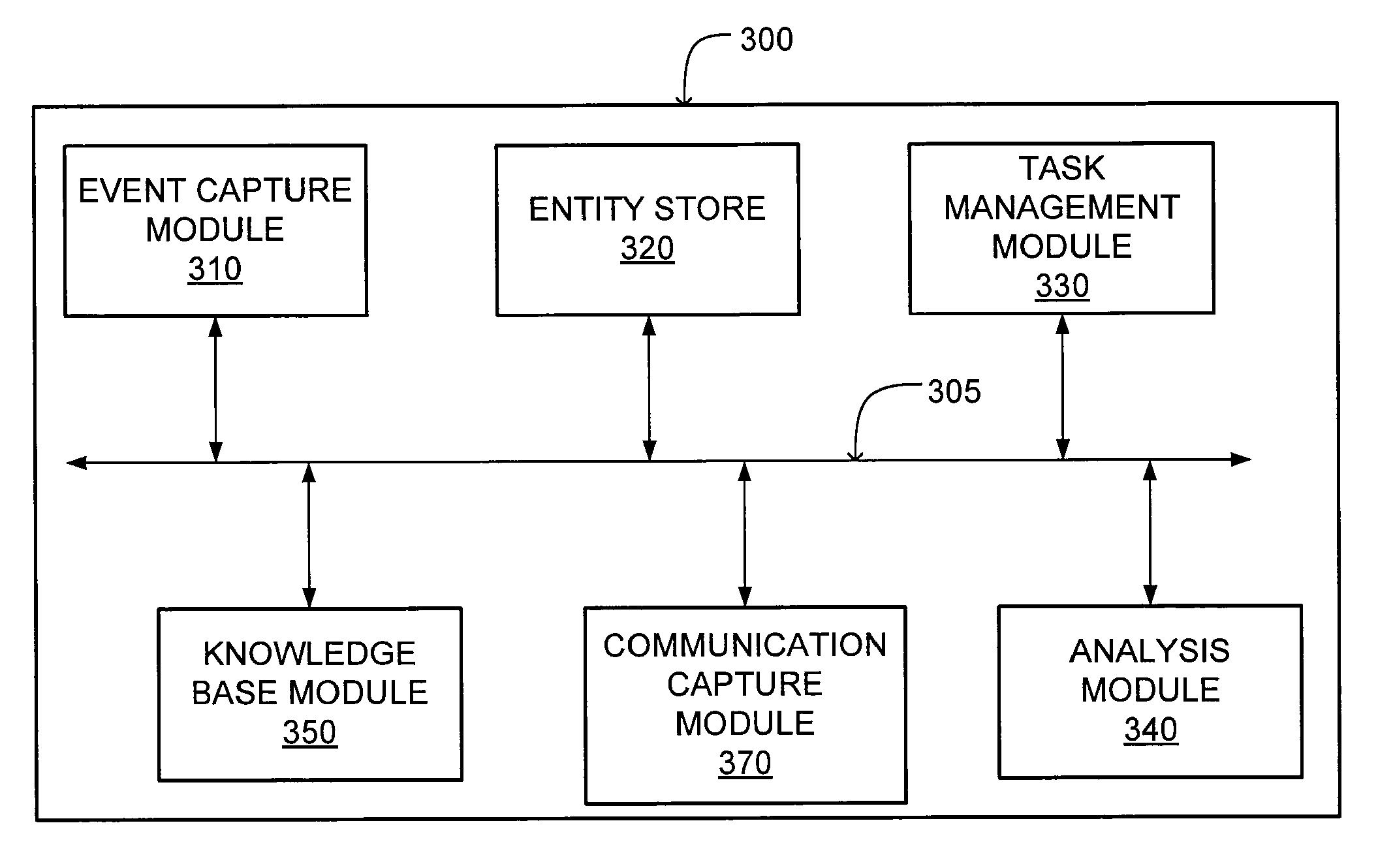

A system and a method are disclosed for implementing managing relationships between data on a mobile computing based on user creation and definition of the relationships. A mobile computing device user generates asymmetric relationships between stored entities, events, tasks and communications. These asymmetric relationships are custom-generated by the user to reflect the user's classification and evaluation of the relationships. The user also assigns a score to each relationship and stored entity, event, task and communication to represent the user's classification of the relationship, entity, event, task or communication. Hence, the user assigns a value to the relationships between data as well as the stored data to indicate which relationship or stored data is most valuable to the user. The user-defined relationships between data can be automatically displayed when the mobile communication device is used to interact with a stored entity.

Owner:QUALCOMM INC

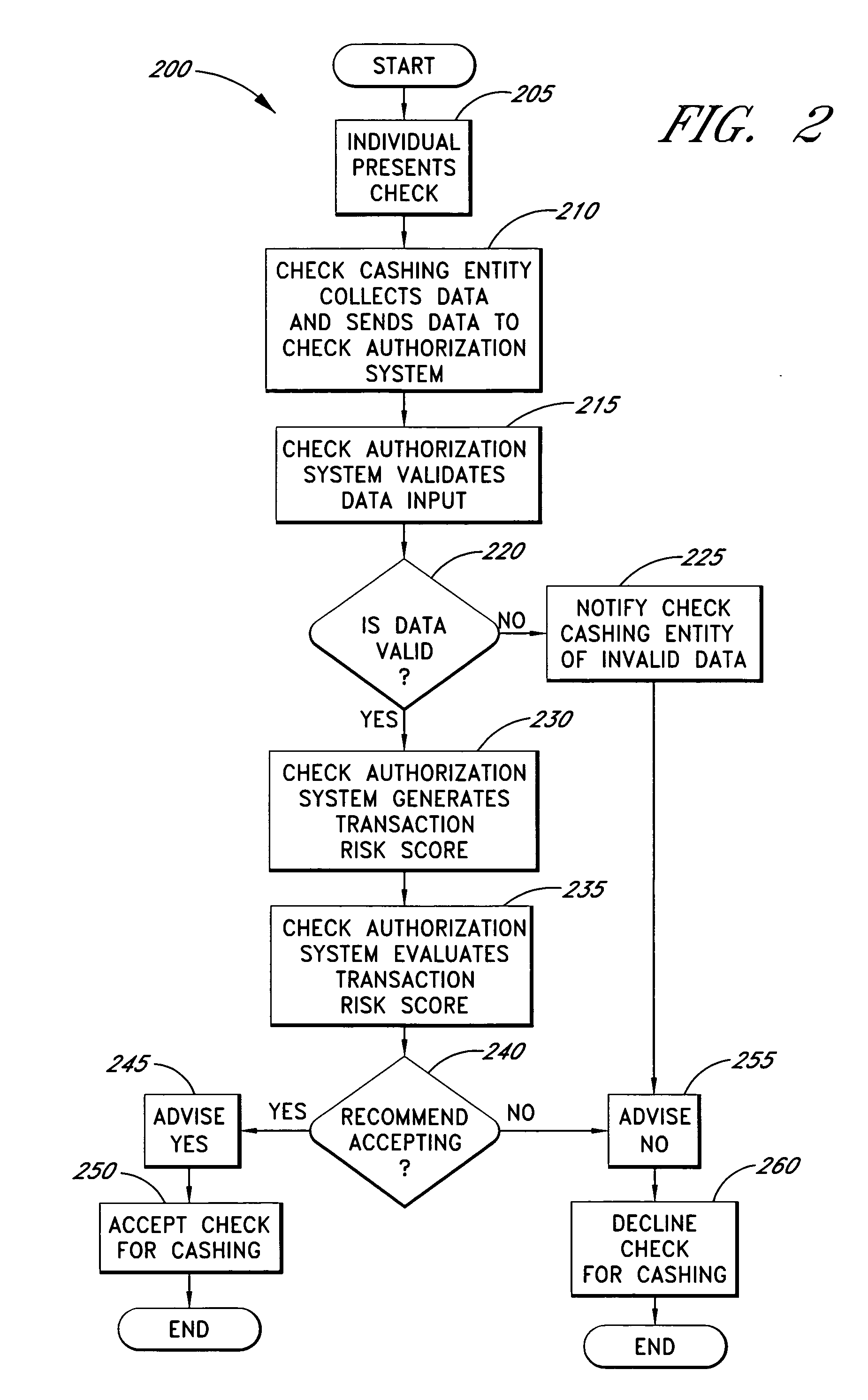

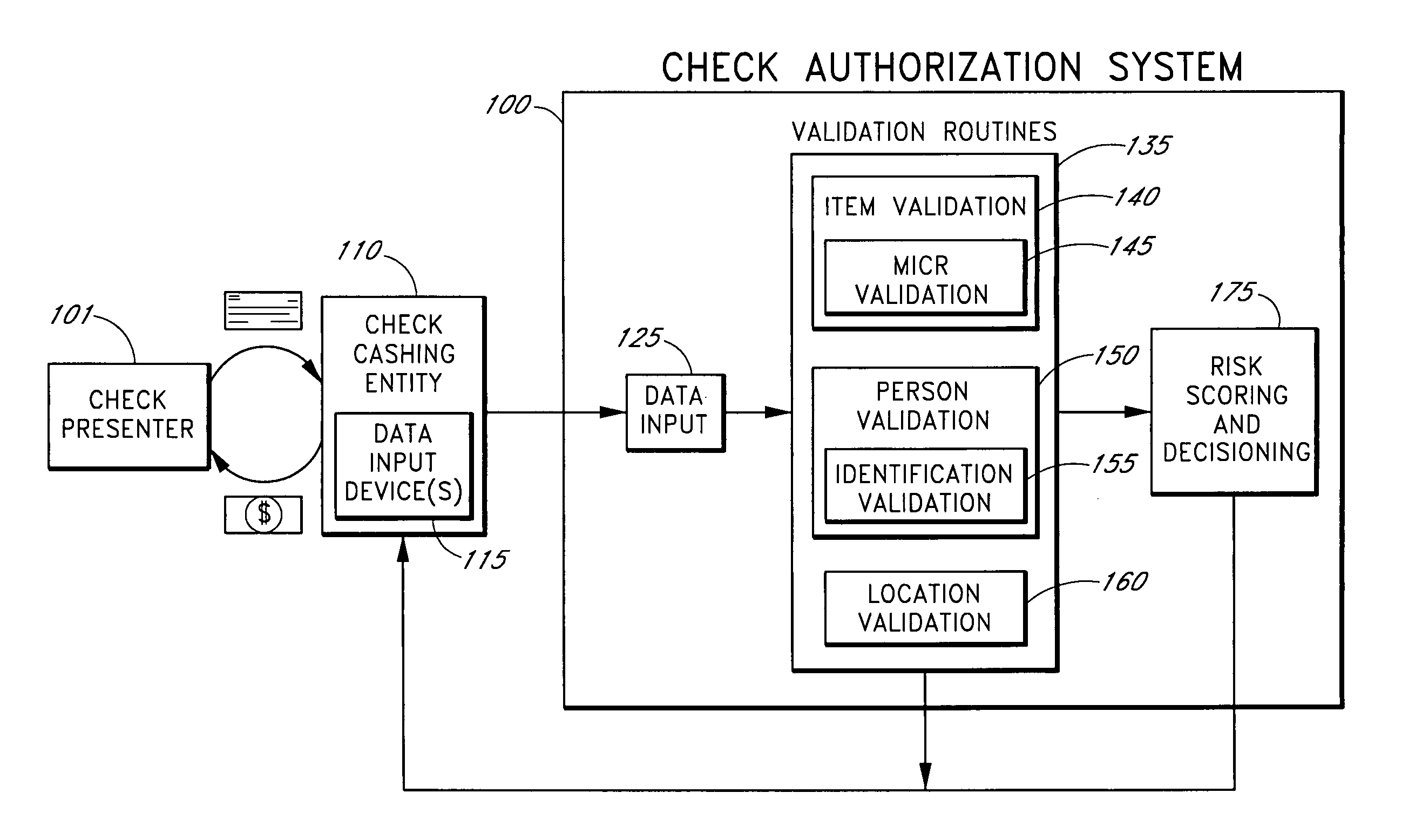

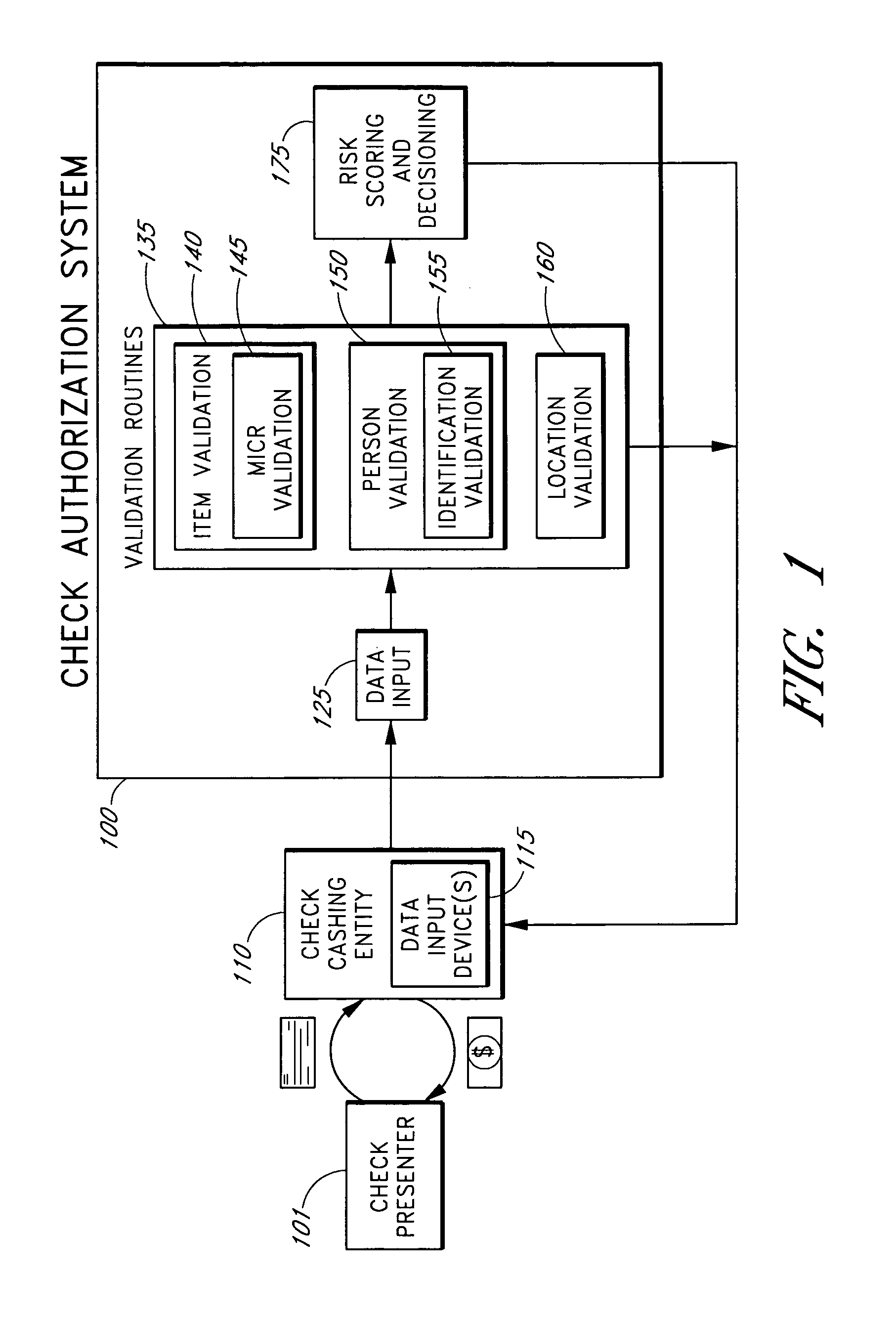

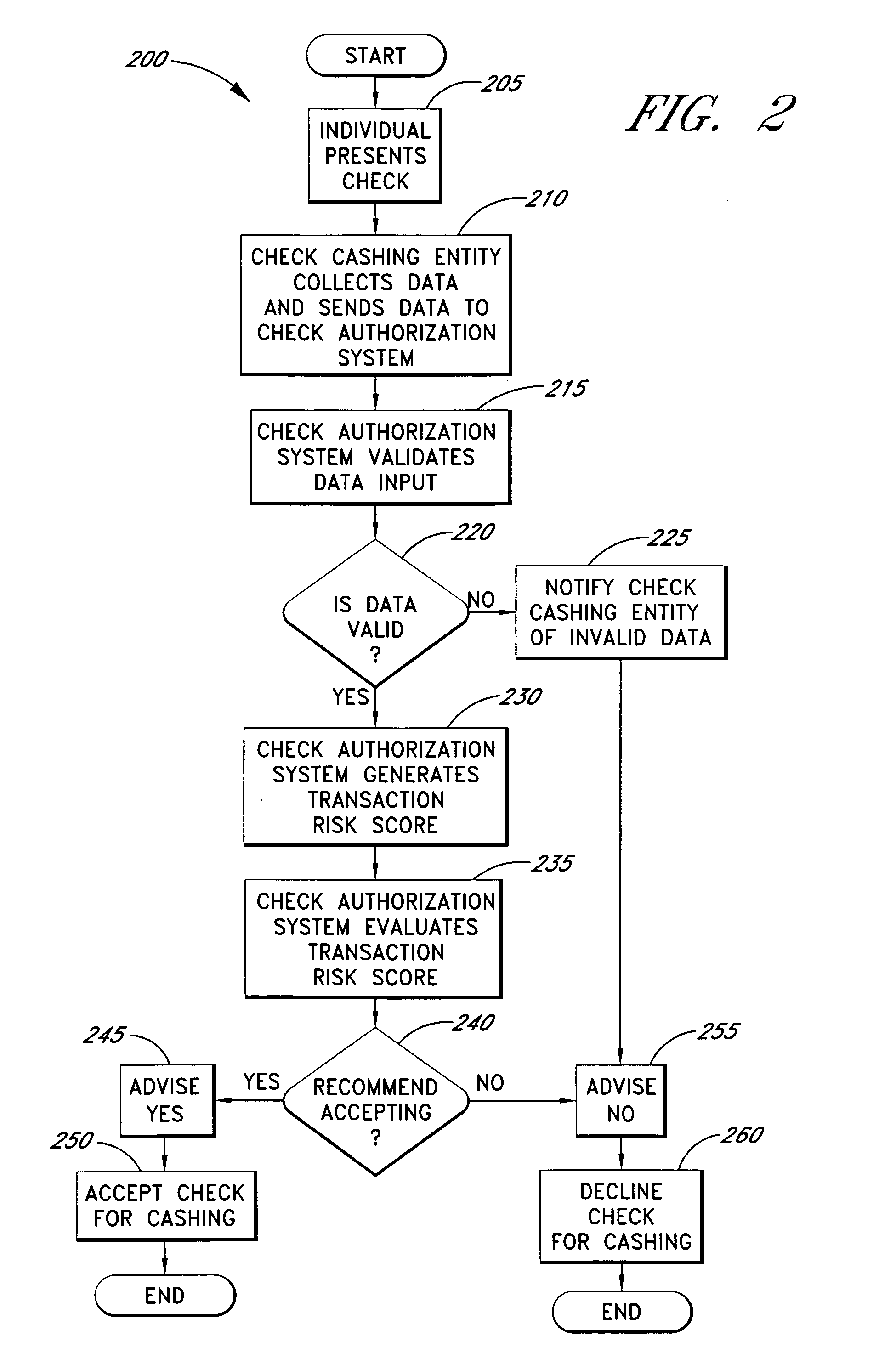

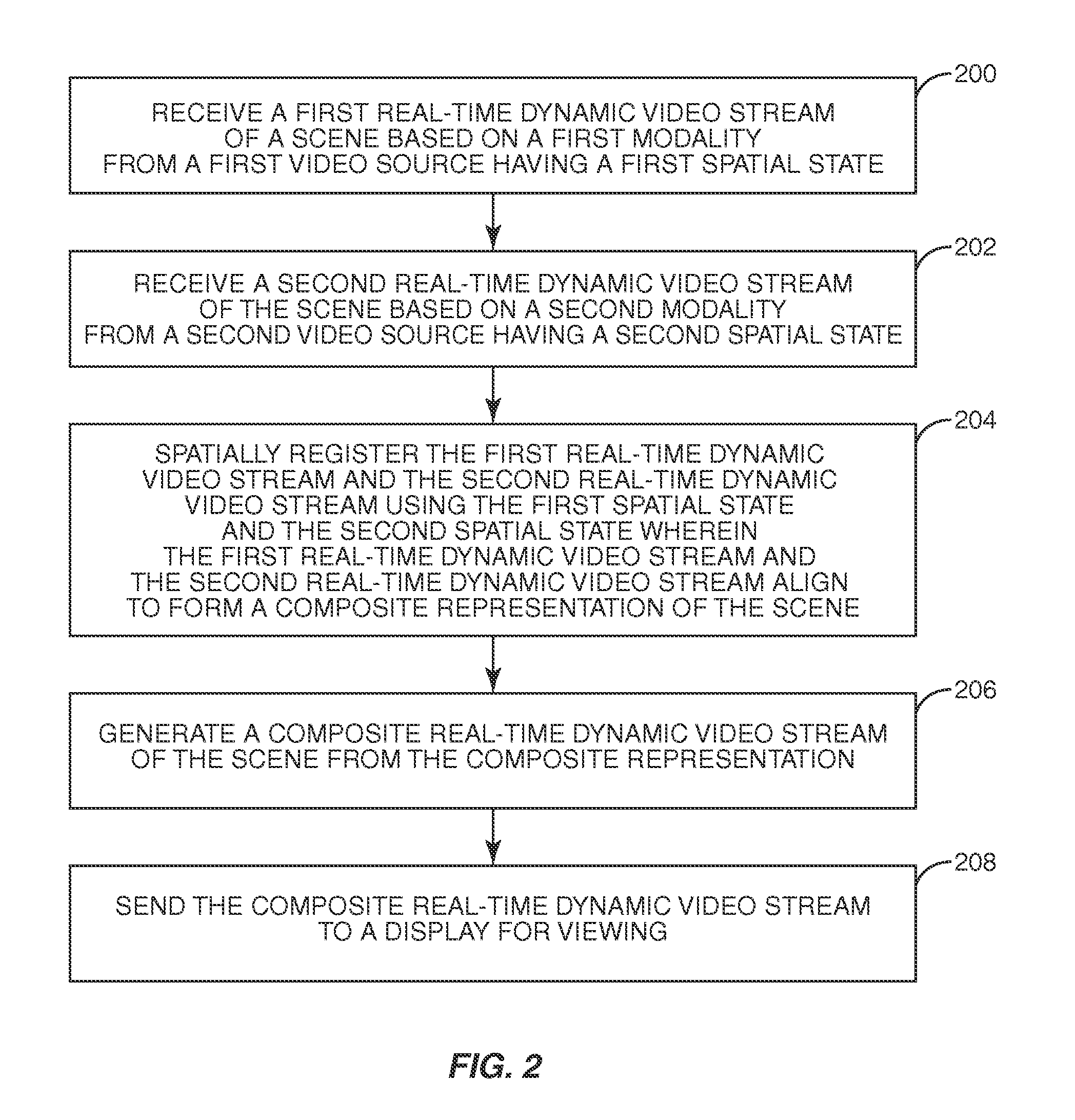

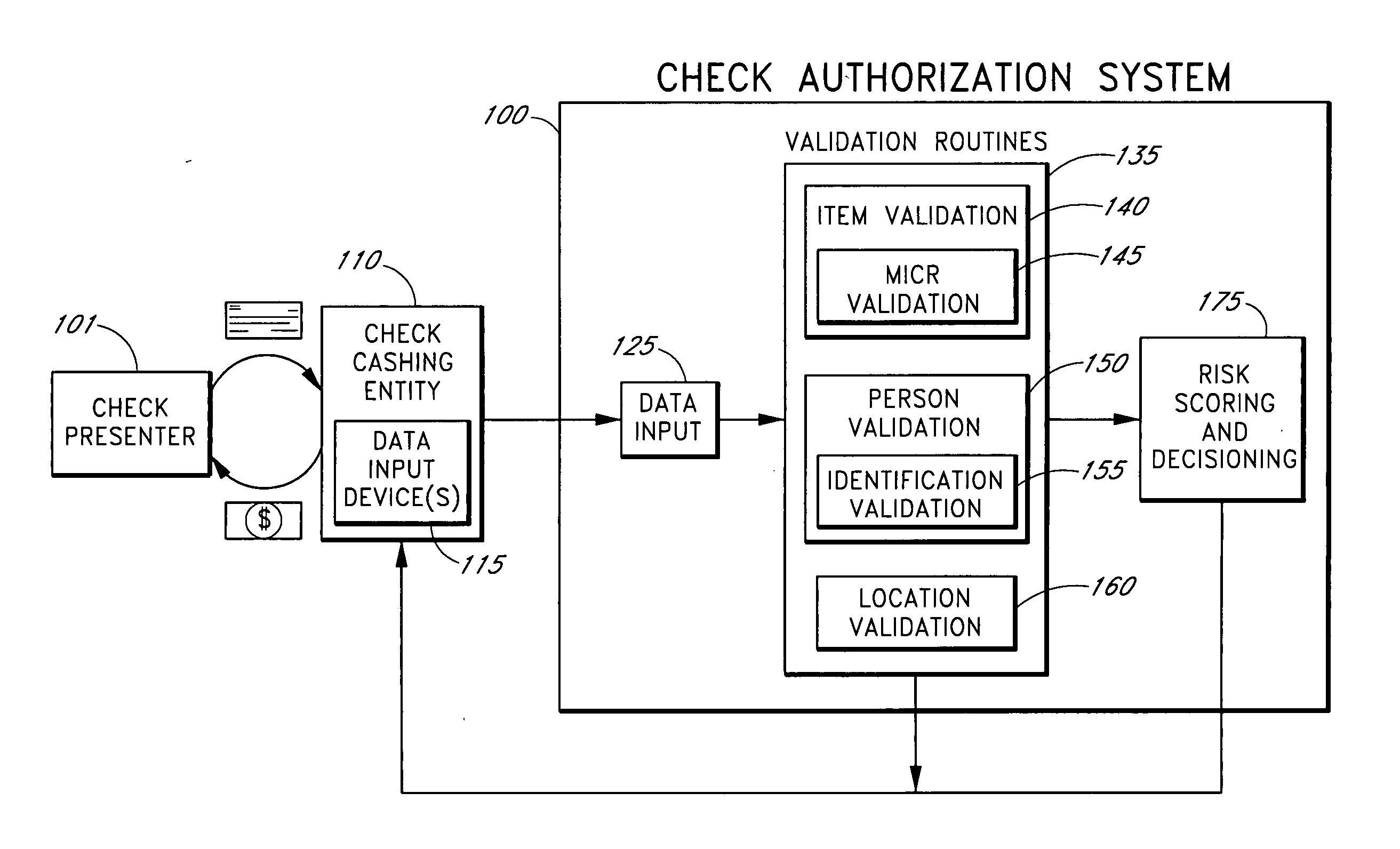

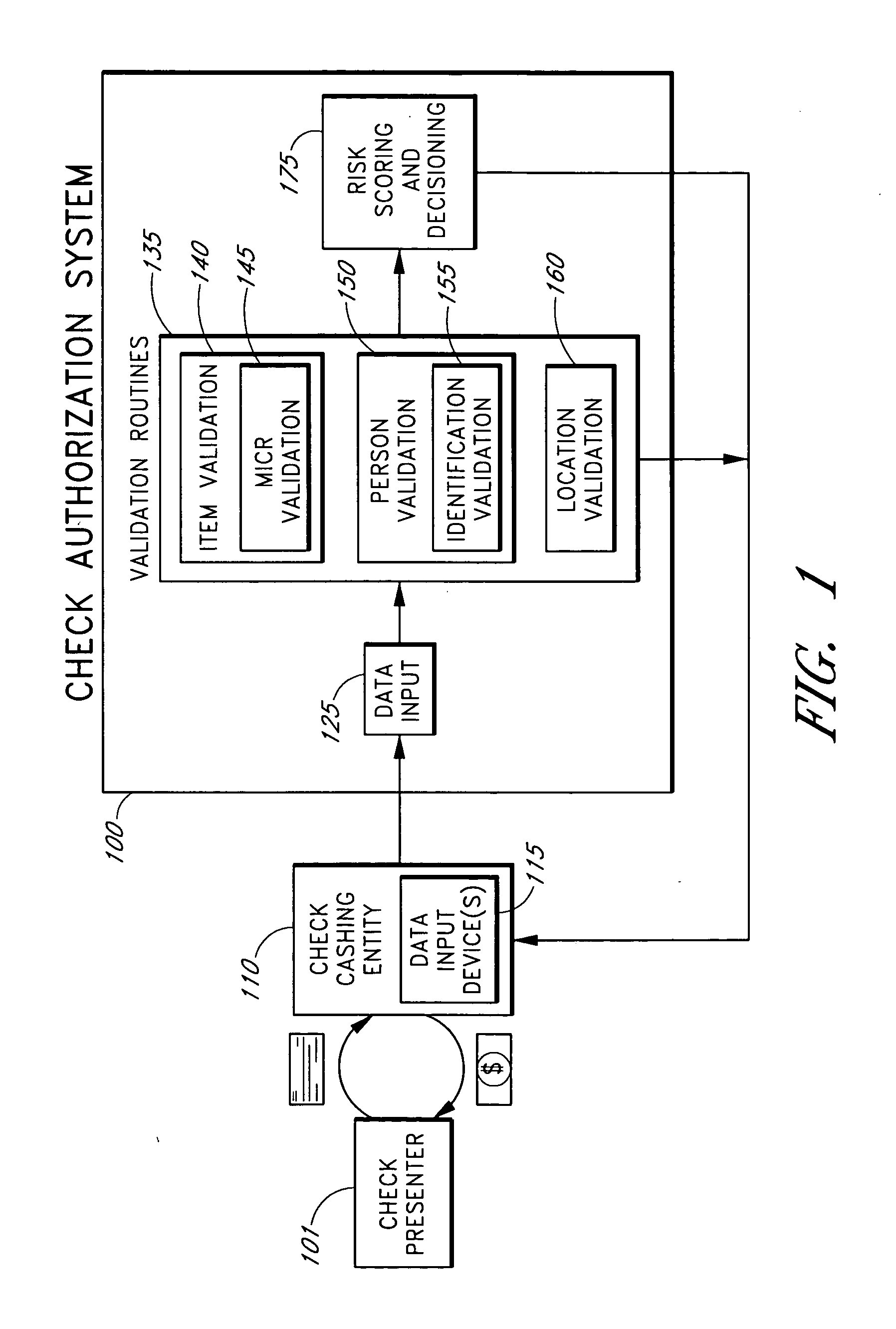

Systems and methods for obtaining authentication marks at a point of sale

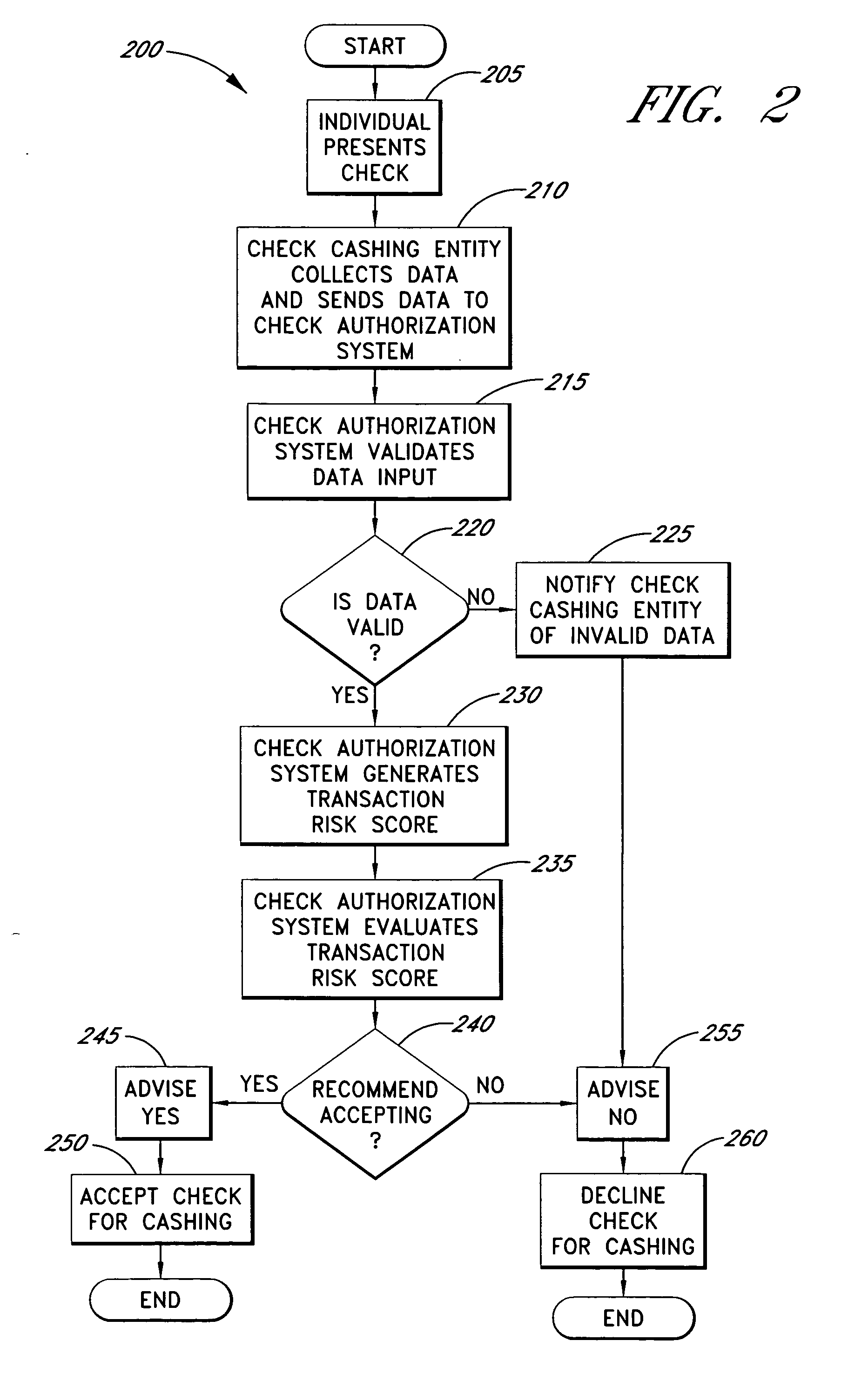

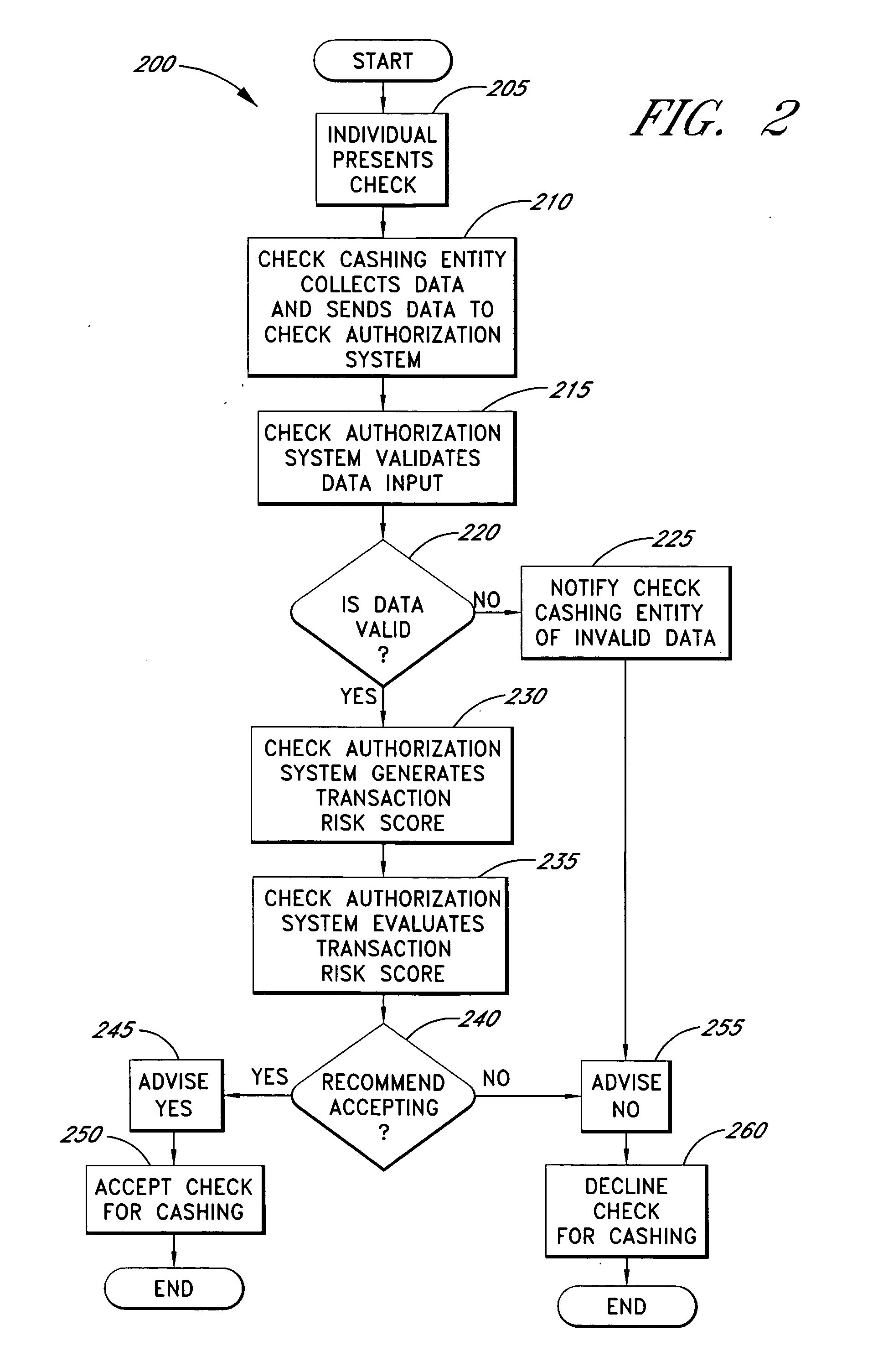

InactiveUS20050125360A1Accurate descriptionSlow processPaper-money testing devicesPoint-of-sale network systemsBarcodeCheque

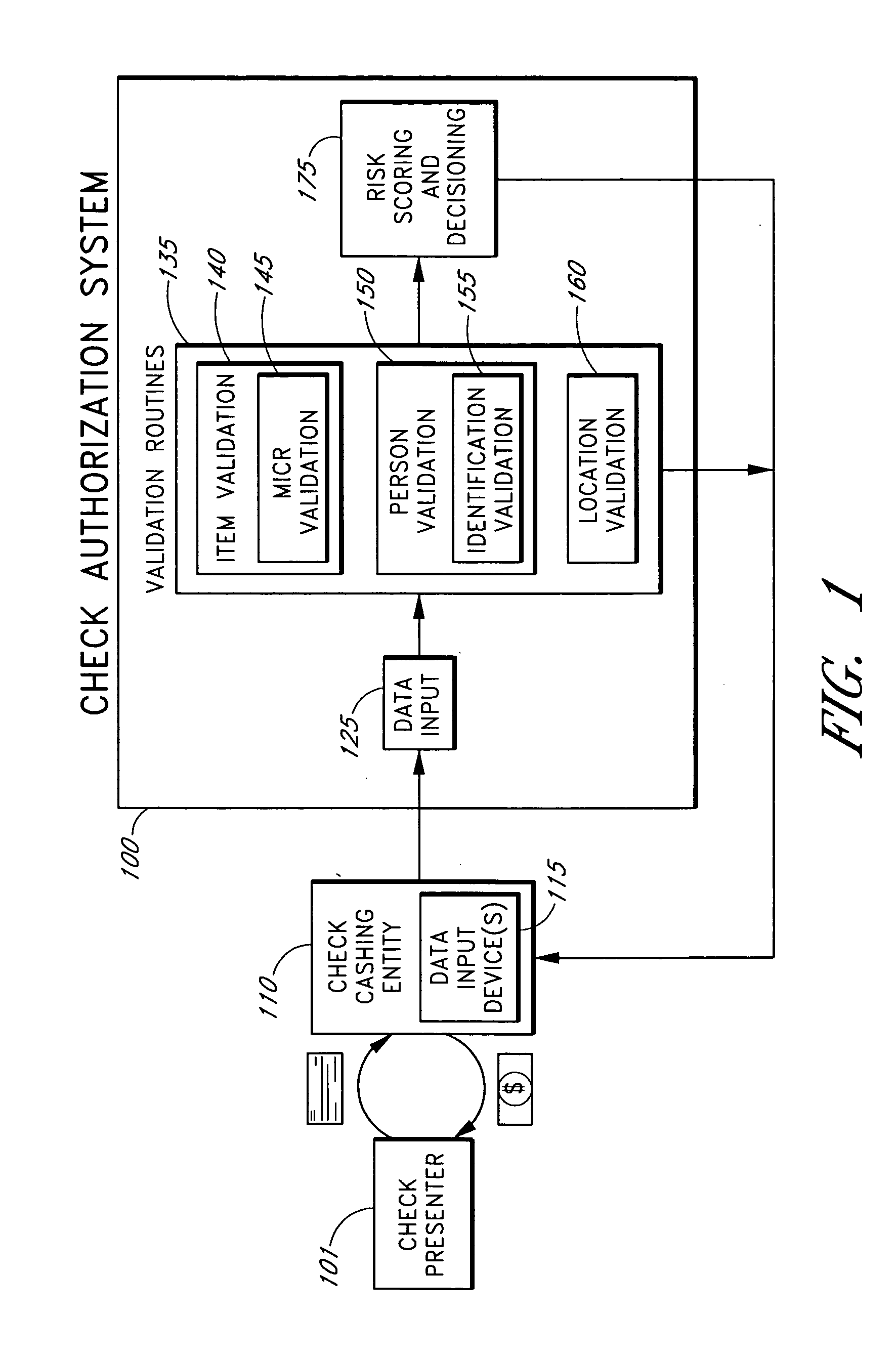

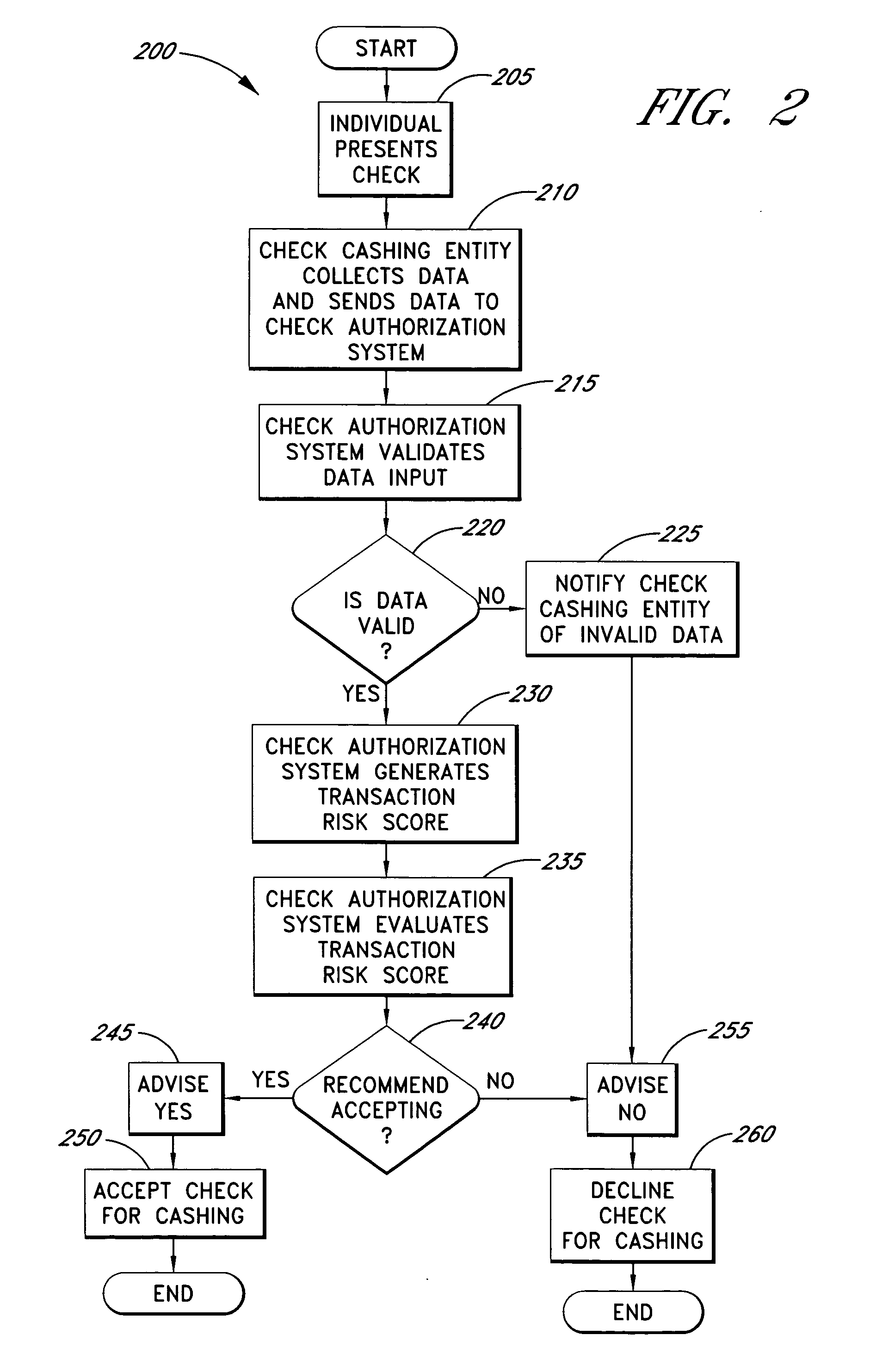

Systems and methods are described for using a point-of-sale device at a check-cashing entity to obtain information about one or more authenticating marks, such as watermarks, bar codes, background patterns, color schemes, insignia, security validation numbers, or the like, from a second-party check or other negotiable instrument presented for a proposed check-cashing transaction. In various embodiments, the authenticating mark information may be compared to stored information about expected configurations of authenticating marks as part of a risk assessment of the check. In various embodiments, the point-of-sale device transmits authenticating mark information to a check authorization system. The point-of-sale device may receive an accept / decline recommendation for the transaction from the check authorization system, based at least in part on the obtained authenticating mark information. The point-of-sale device may display a message about the recommendation to an operator of the device.

Owner:FIRST DATA

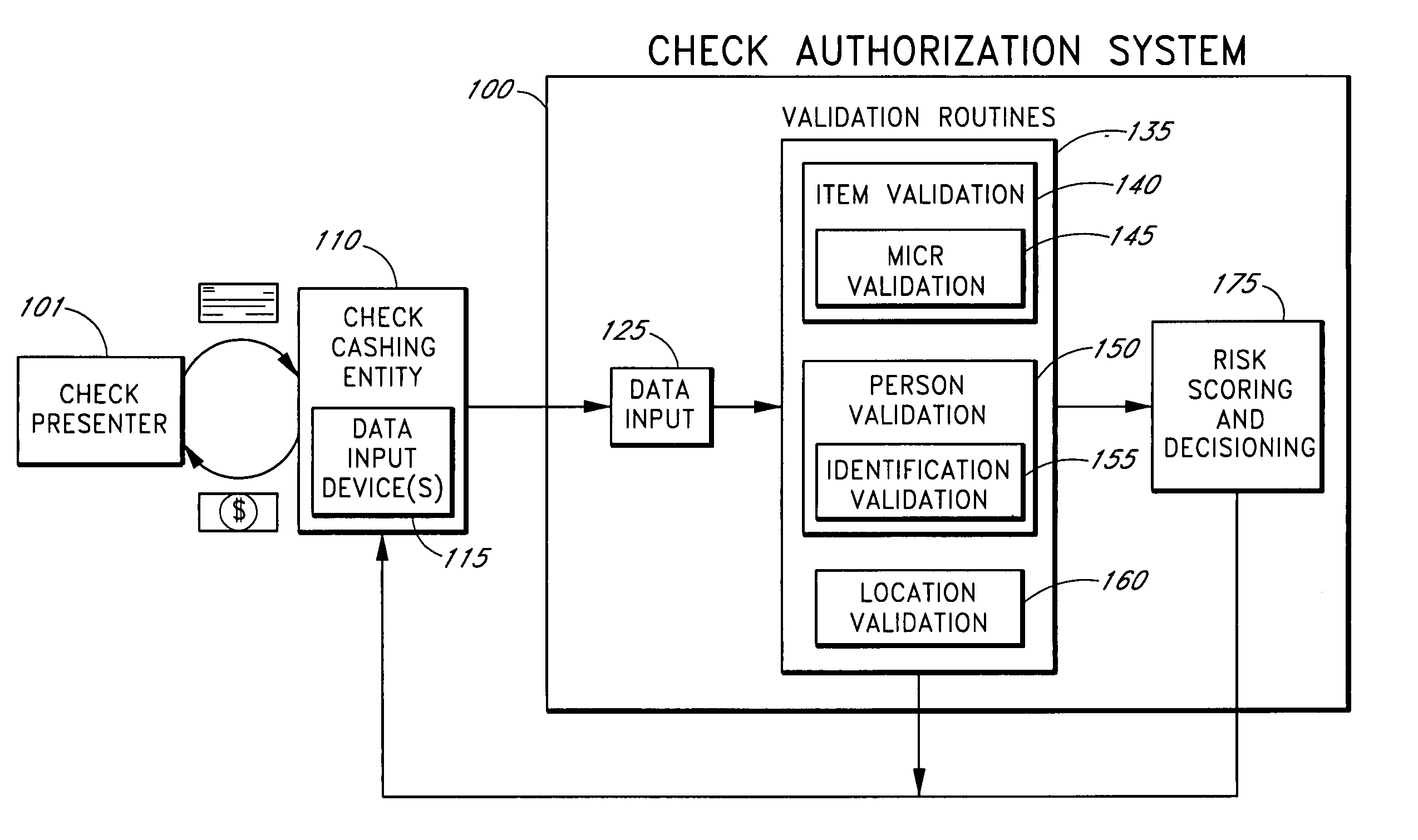

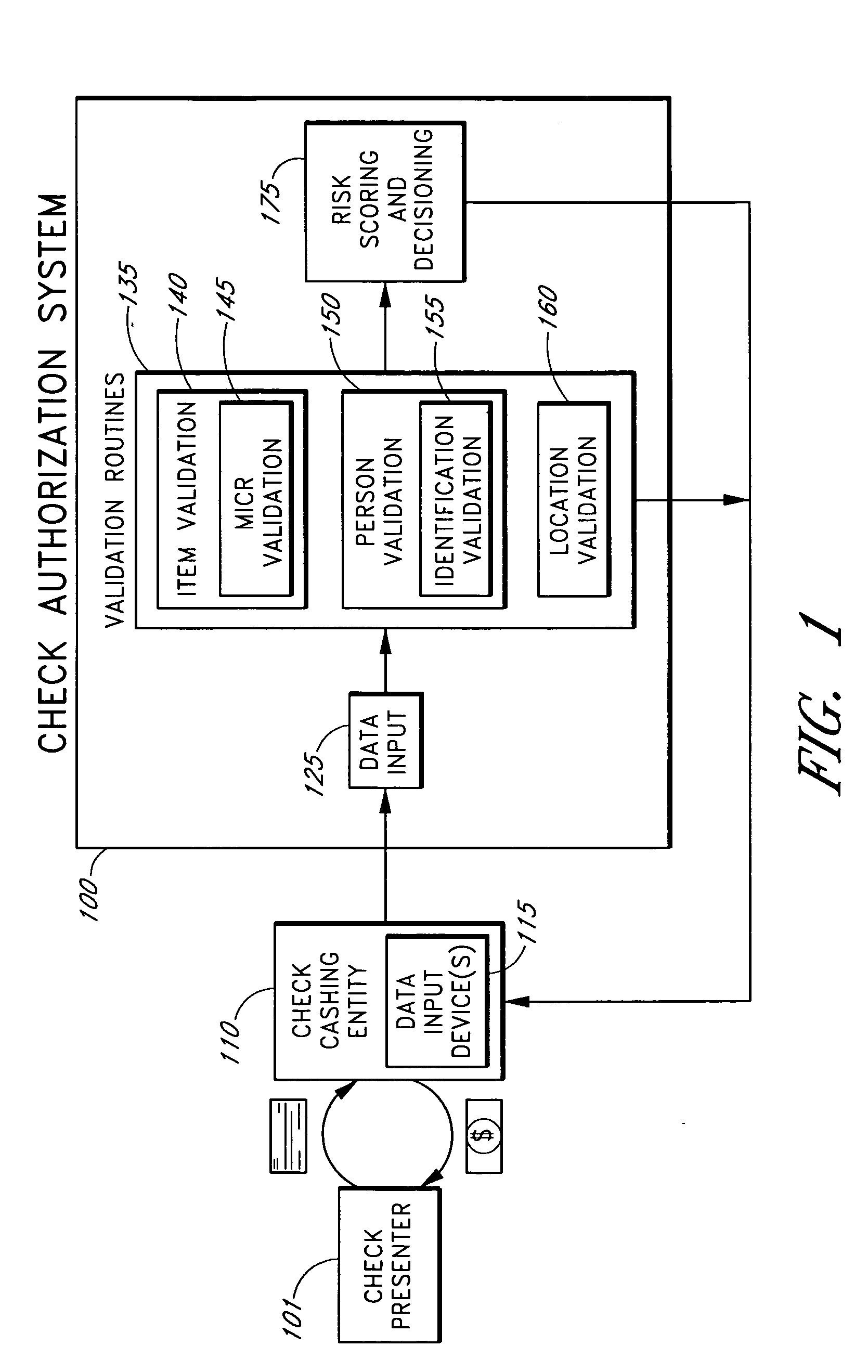

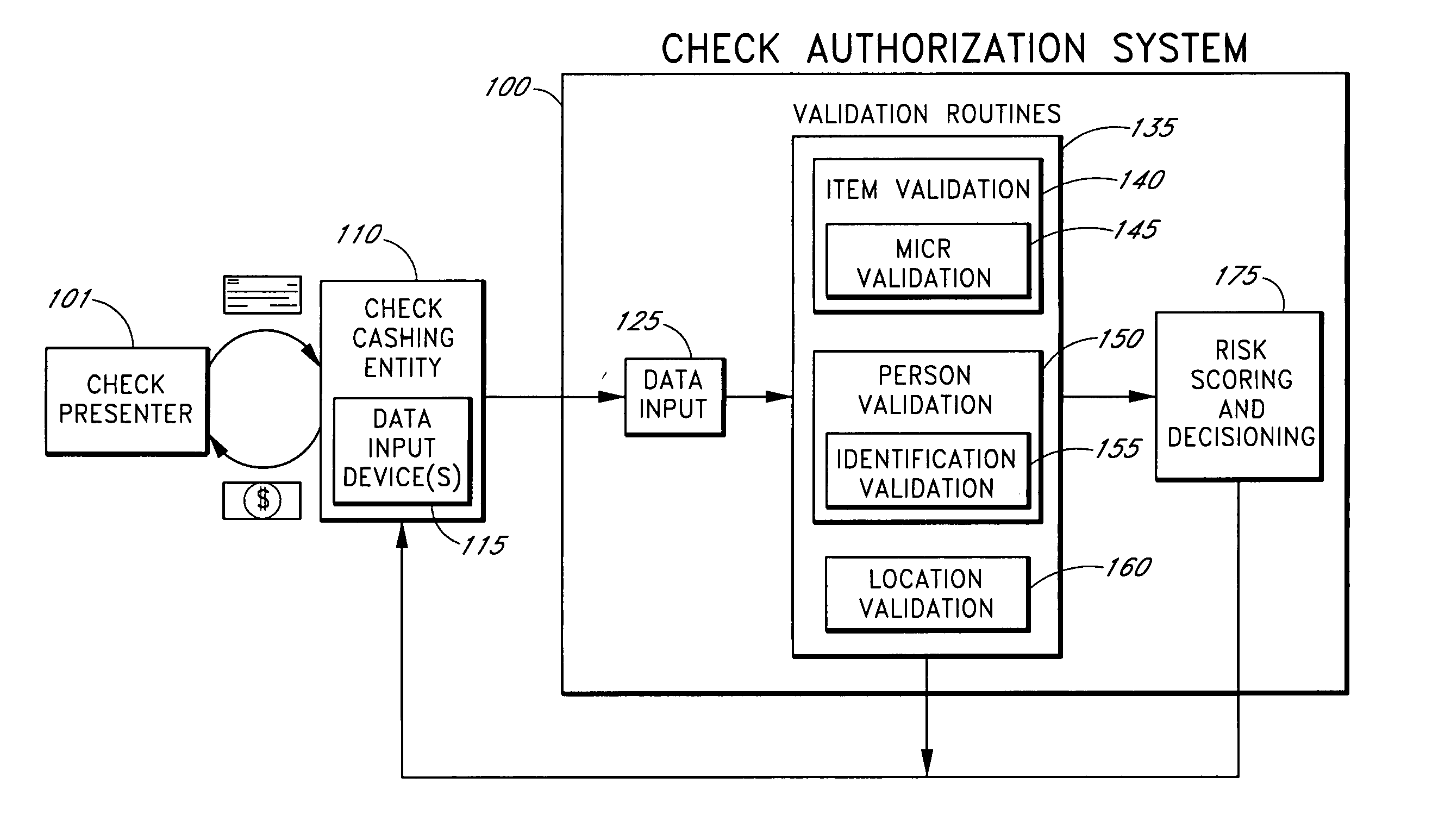

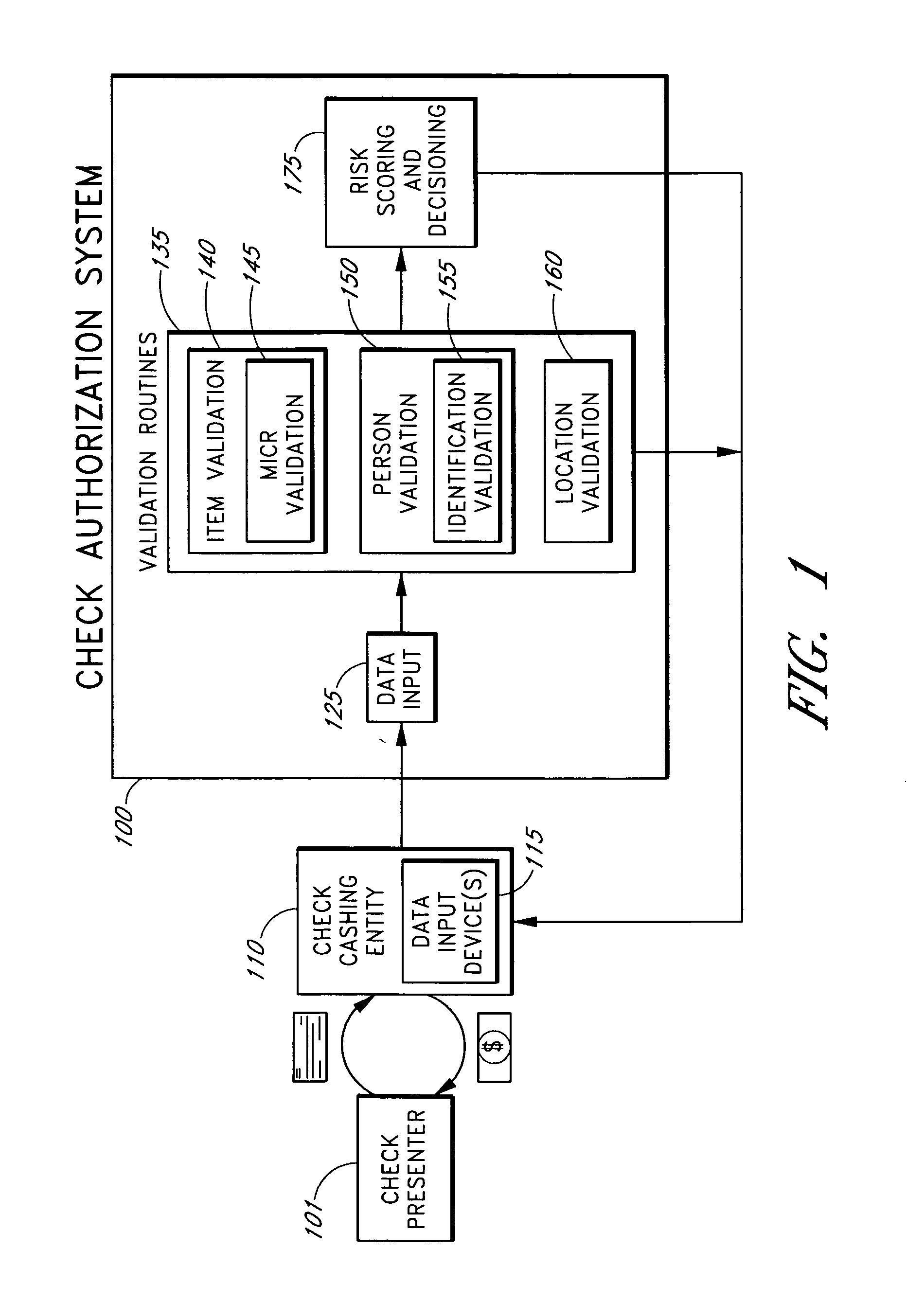

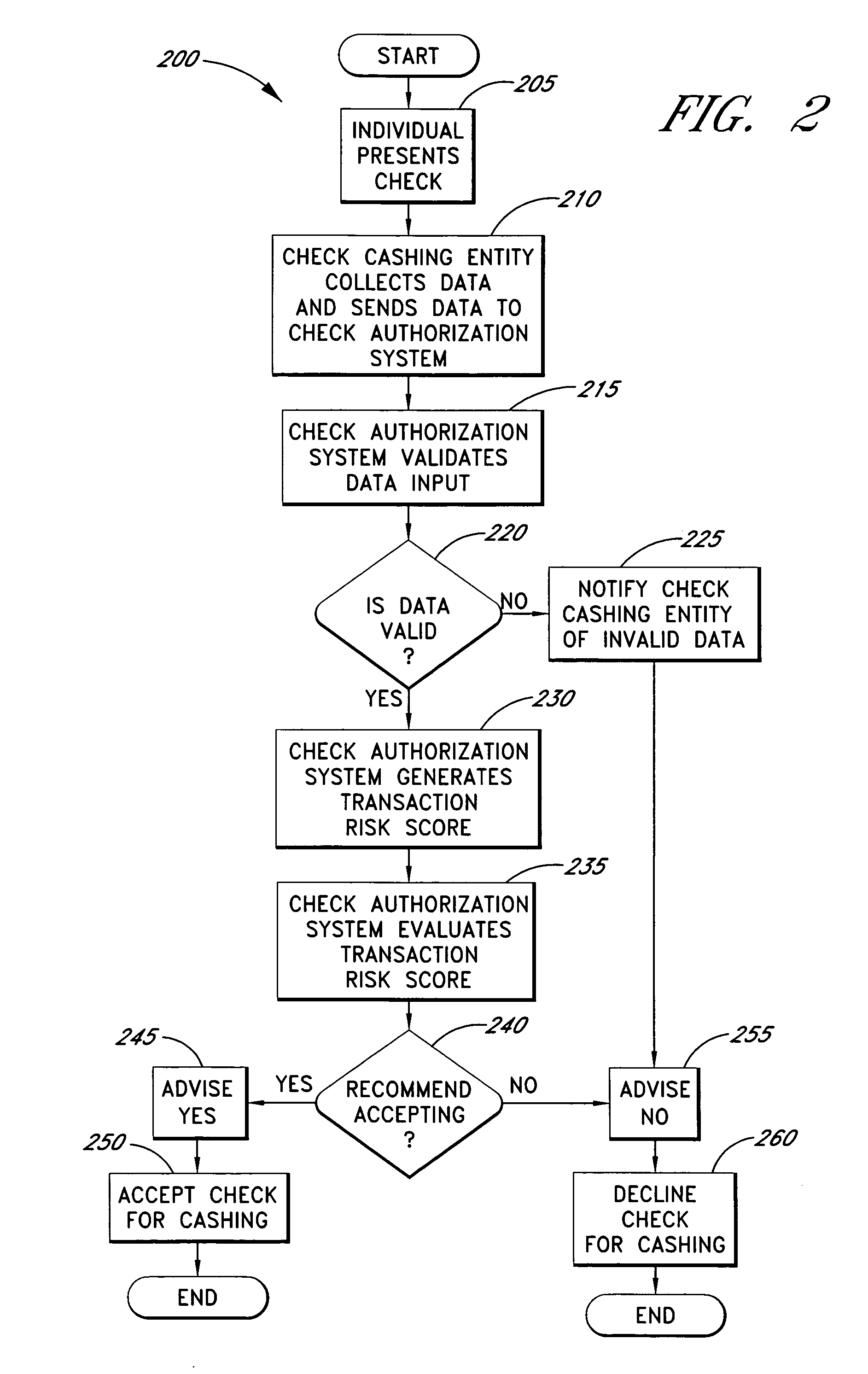

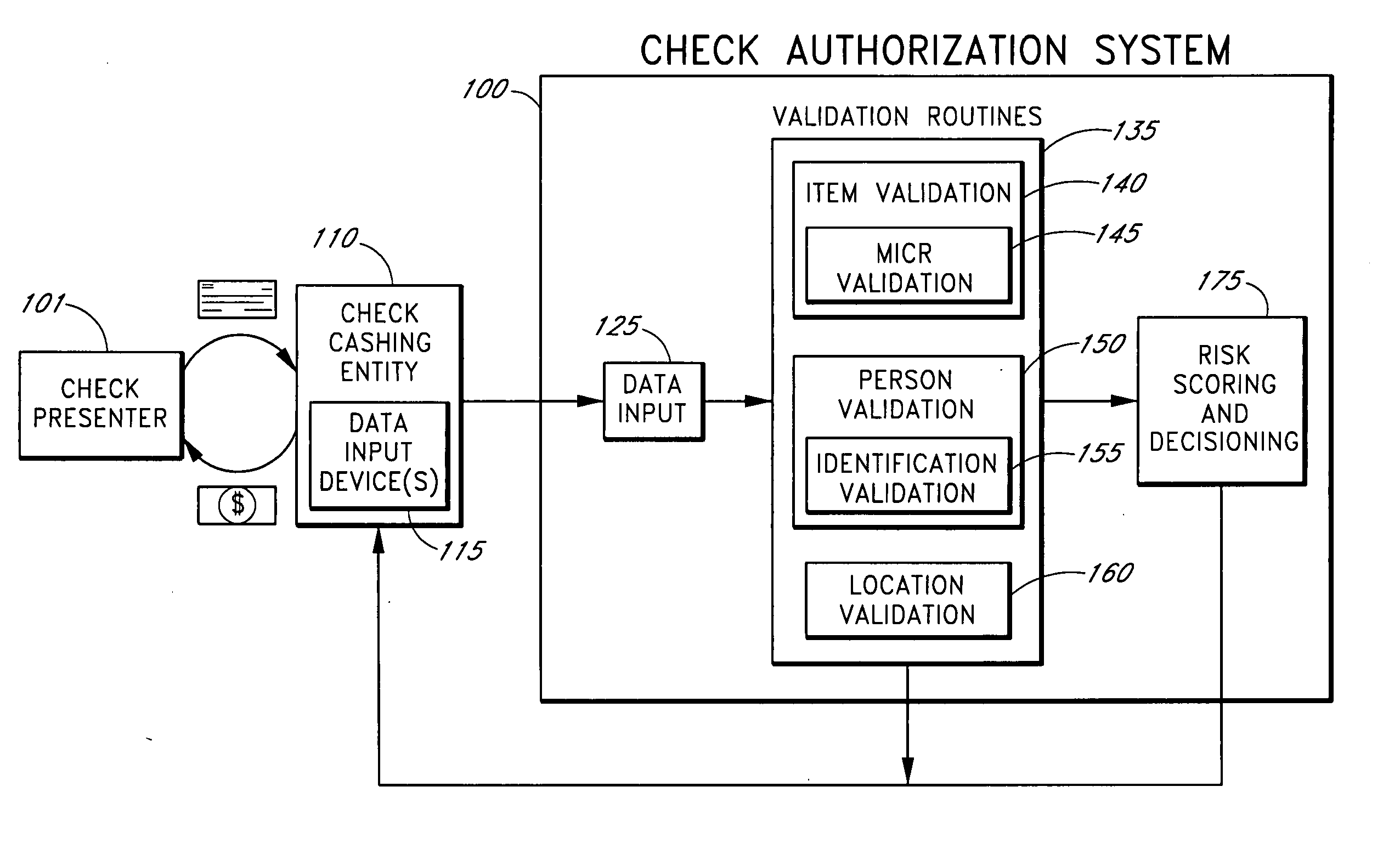

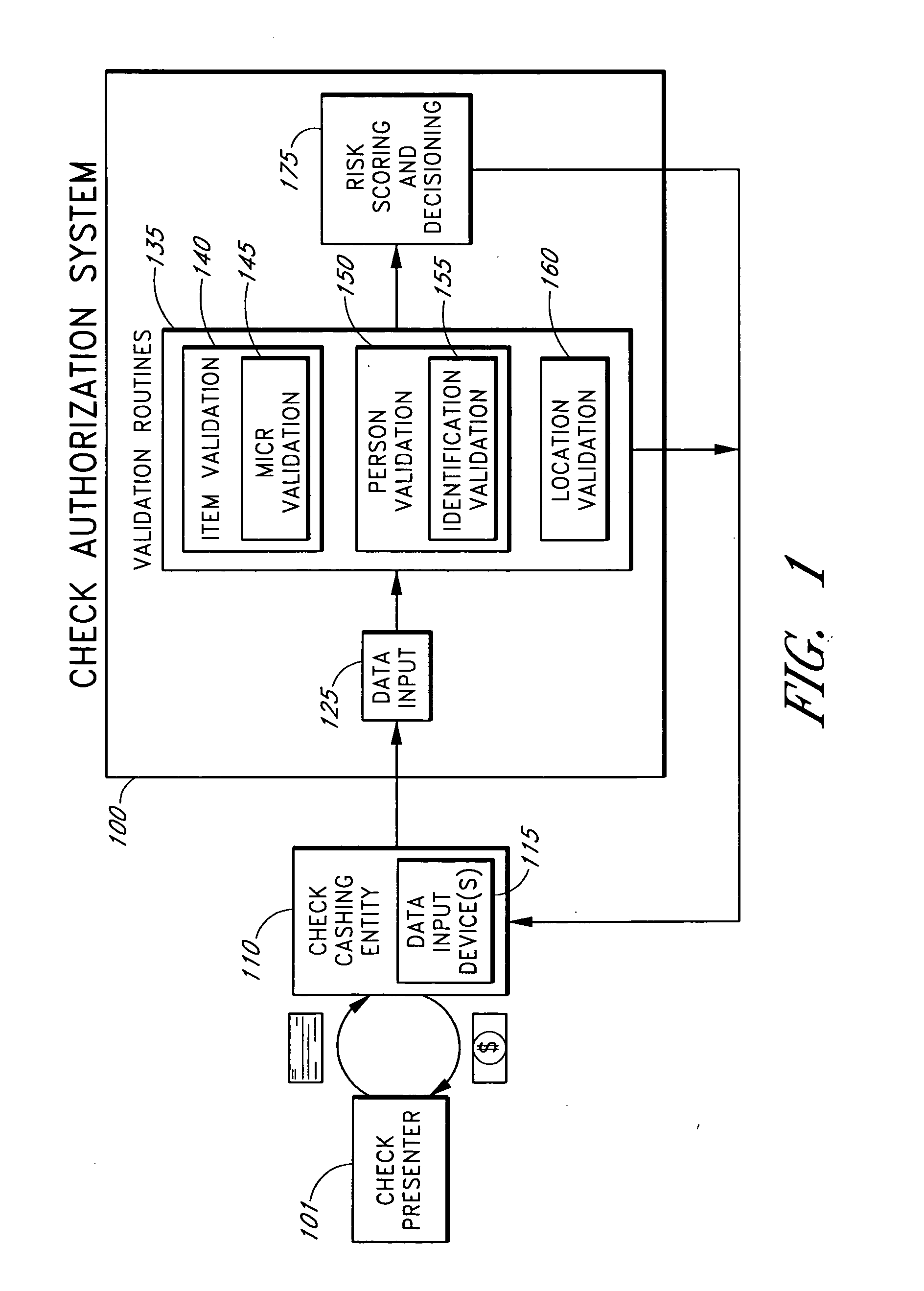

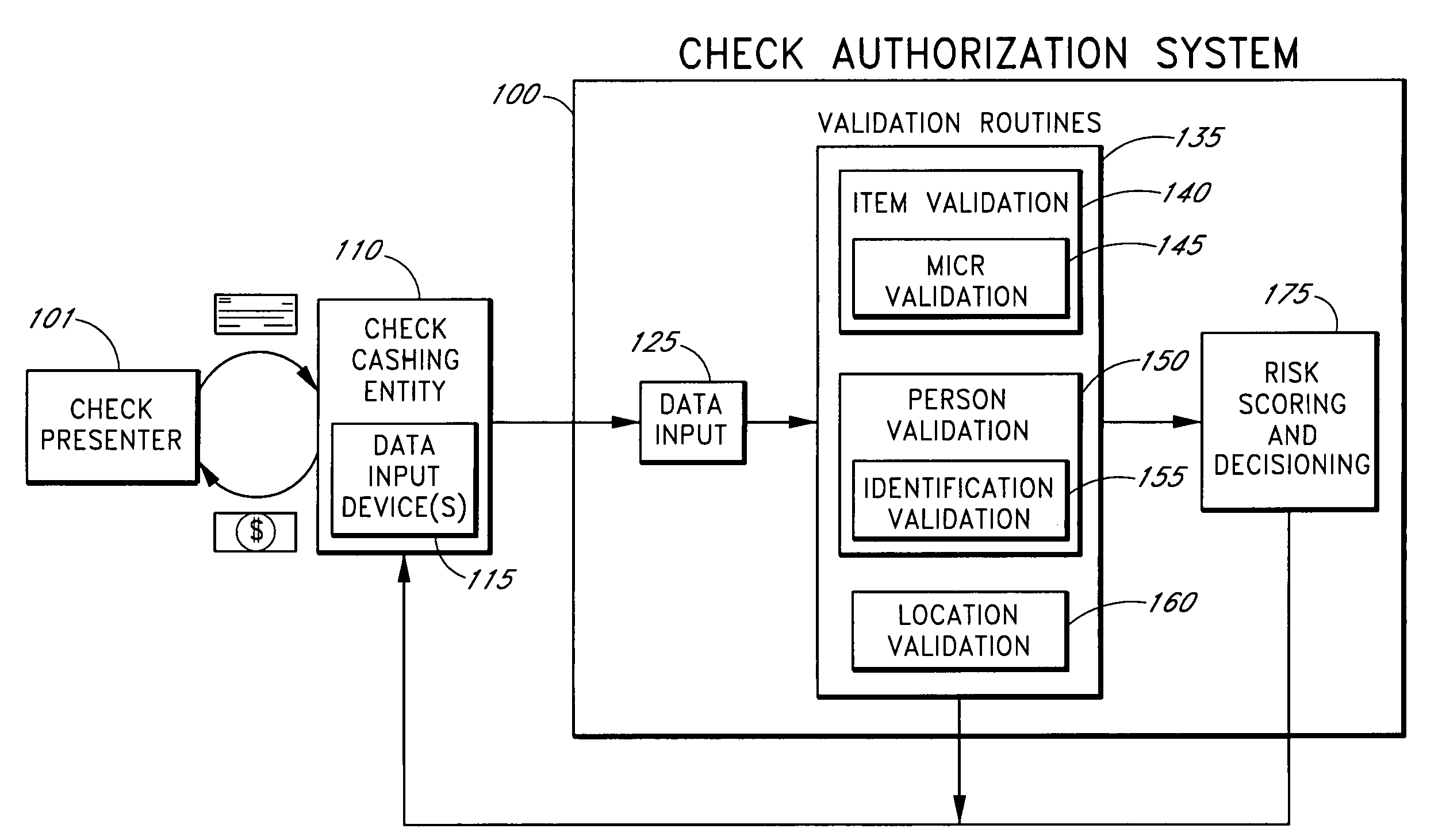

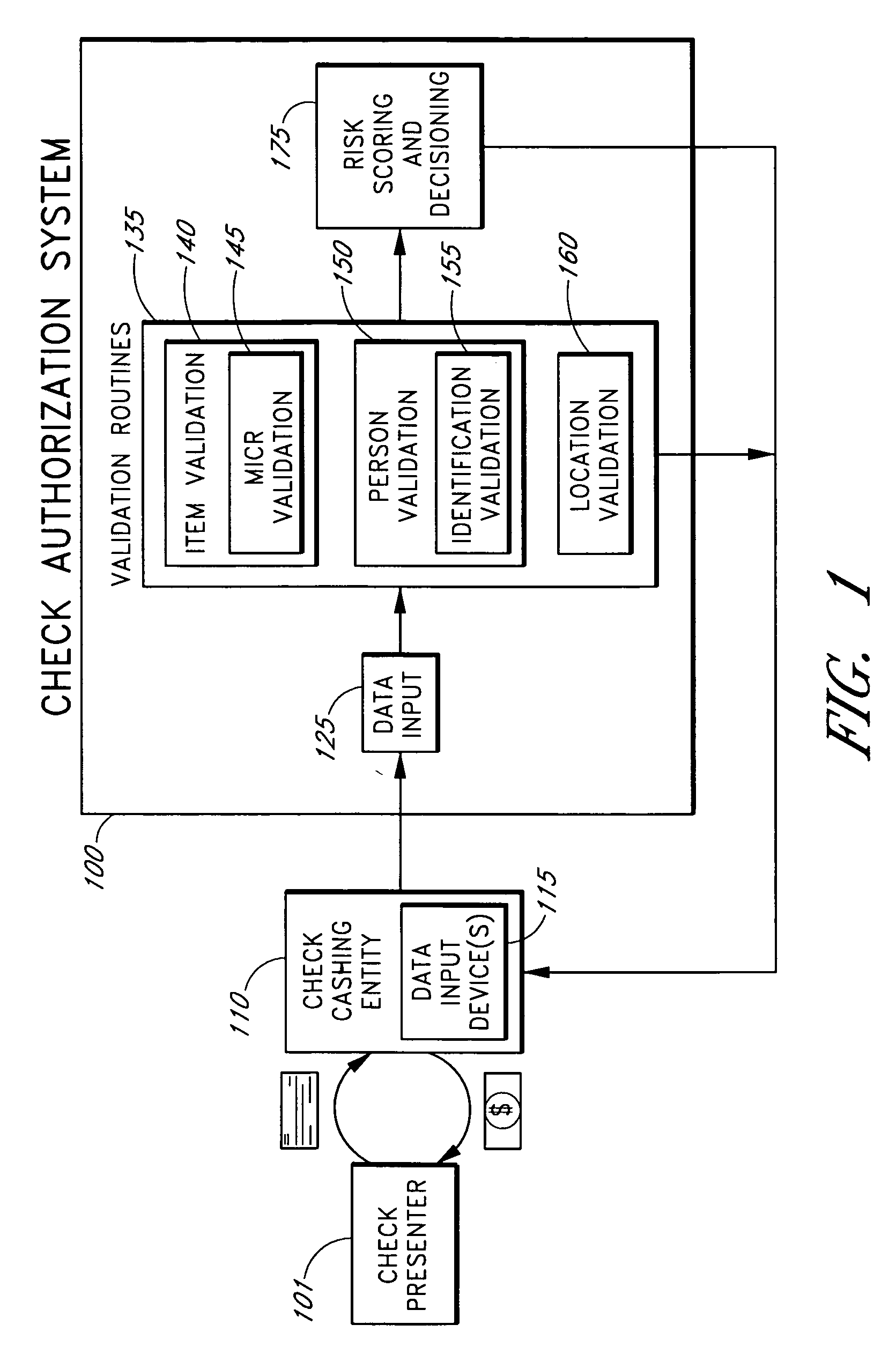

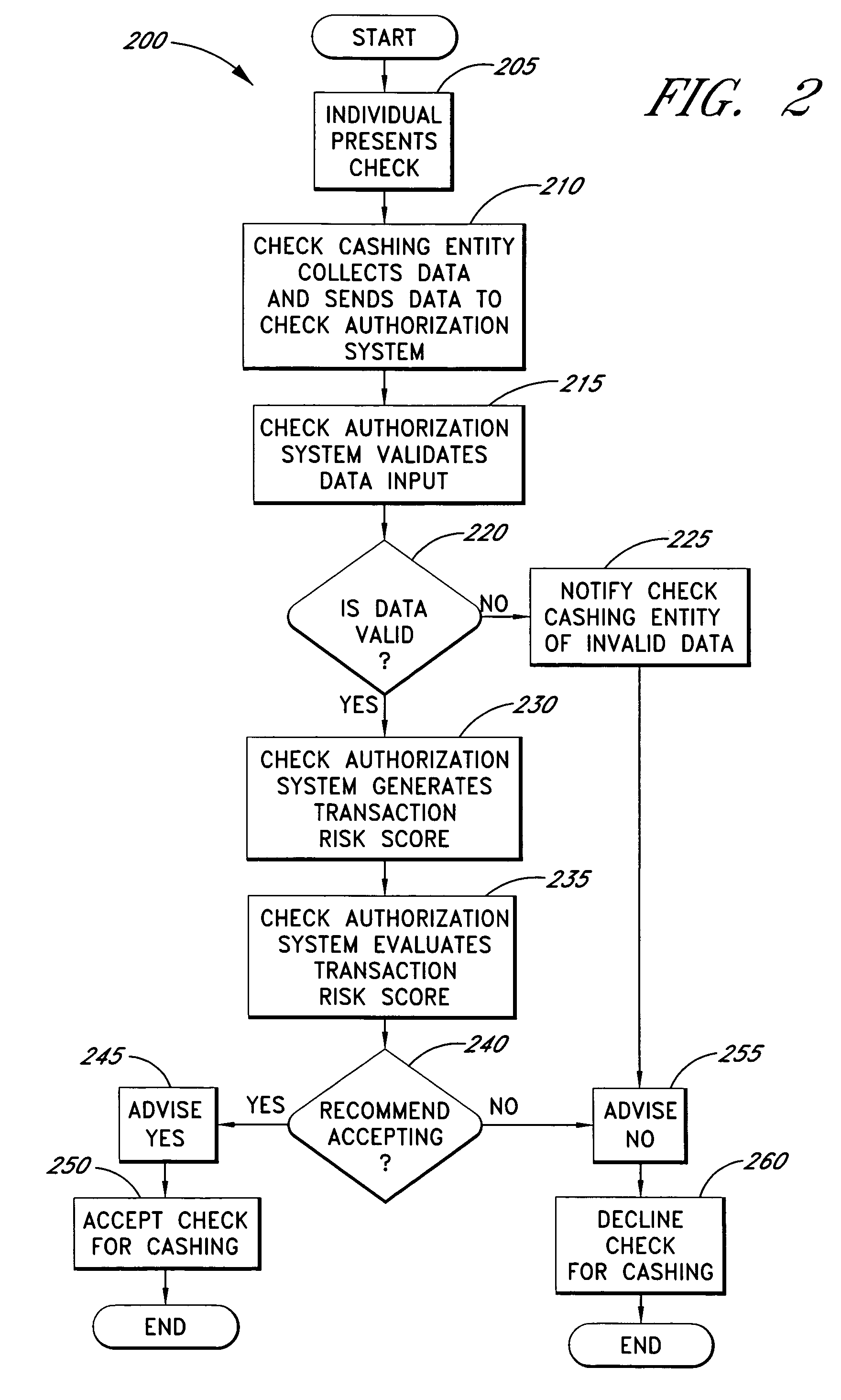

Systems and methods for assessing the risk of a financial transaction using reconciliation information

InactiveUS20050125338A1Accurate descriptionSlow processFinancePayment architectureChequeFinancial transaction

Systems and methods are described for better assessing risk associated with cashing second-party checks and other negotiable instruments using positive pay or other reconciliation information about a check presented for cashing. Positive pay information, which may be made available by a check issuer, provides a list of checks that have been, for example, issued and not yet cashed, already cashed, voided, stolen, and the like, thus providing an indication of whether the check issuer is willing to honor the checks. In various embodiments, positive pay information about a check may be expressed as a gradated positive pay risk score. In various embodiments, the positive pay risk score may be combined with risk scores that are descriptive of other aspects of the check cashing transaction to calculate a risk score for the transaction as a whole. In some embodiments, the risk scores may be used to generate an accept / decline recommendation for the transaction as a whole.

Owner:FIRST DATA

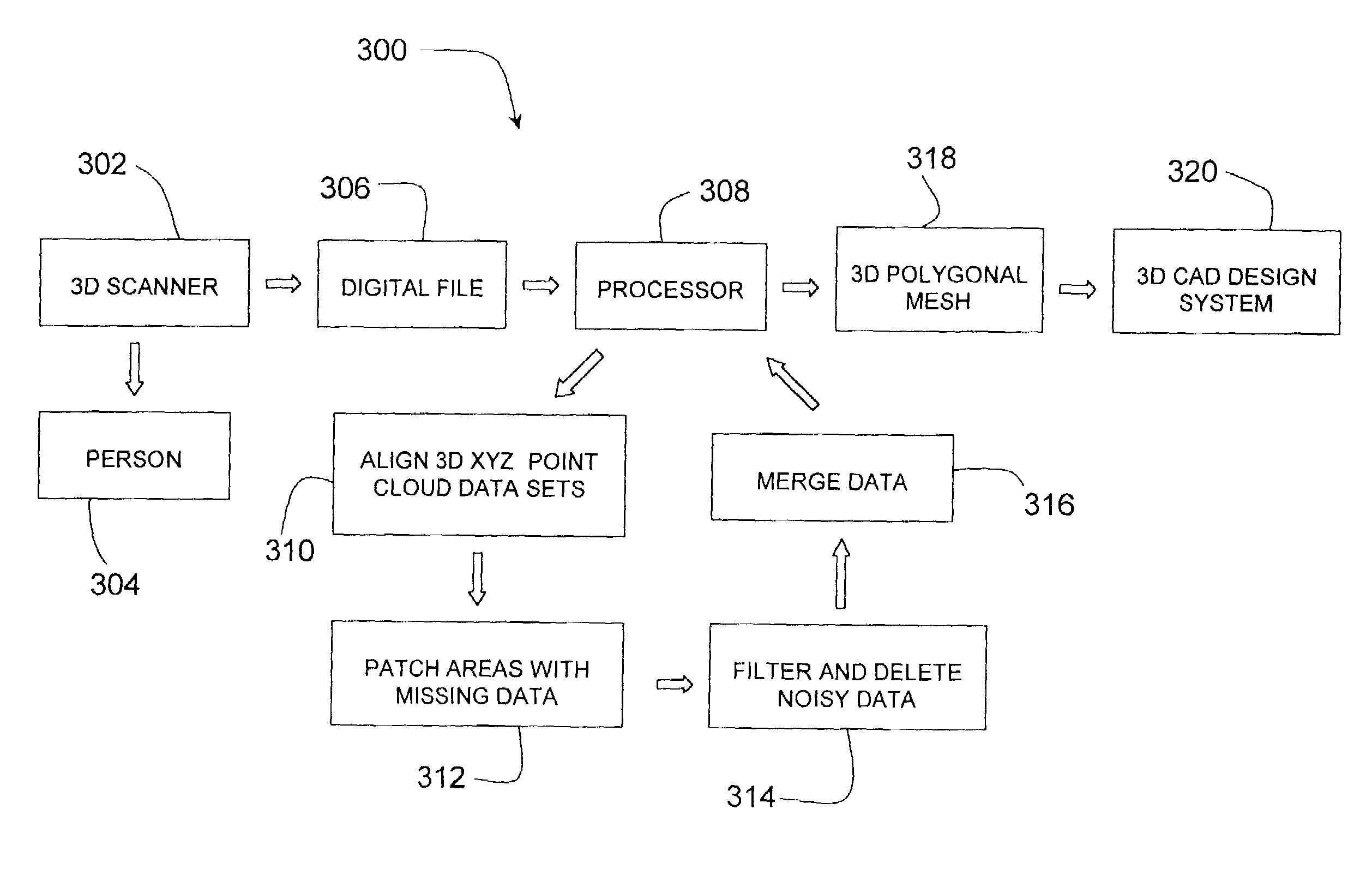

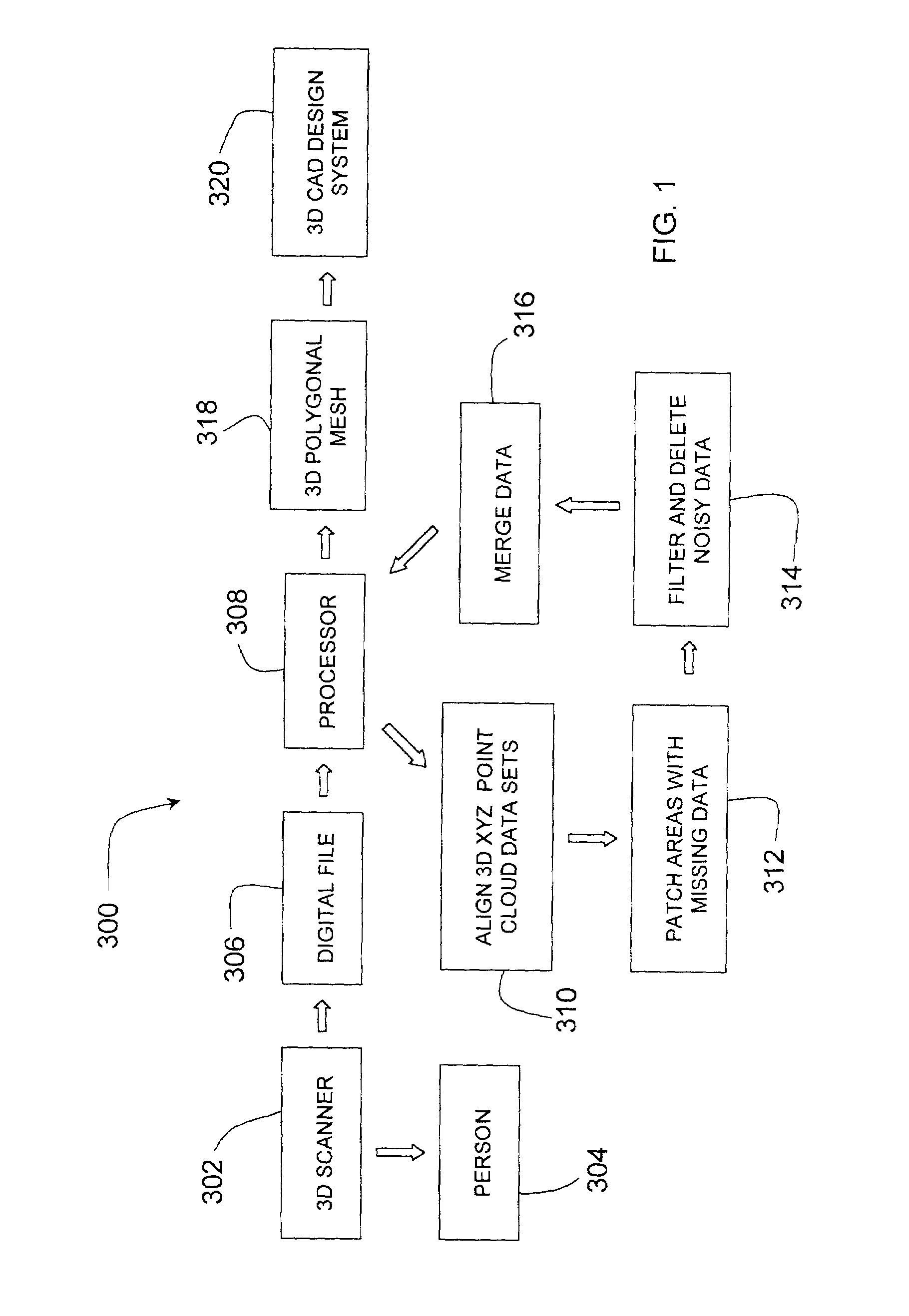

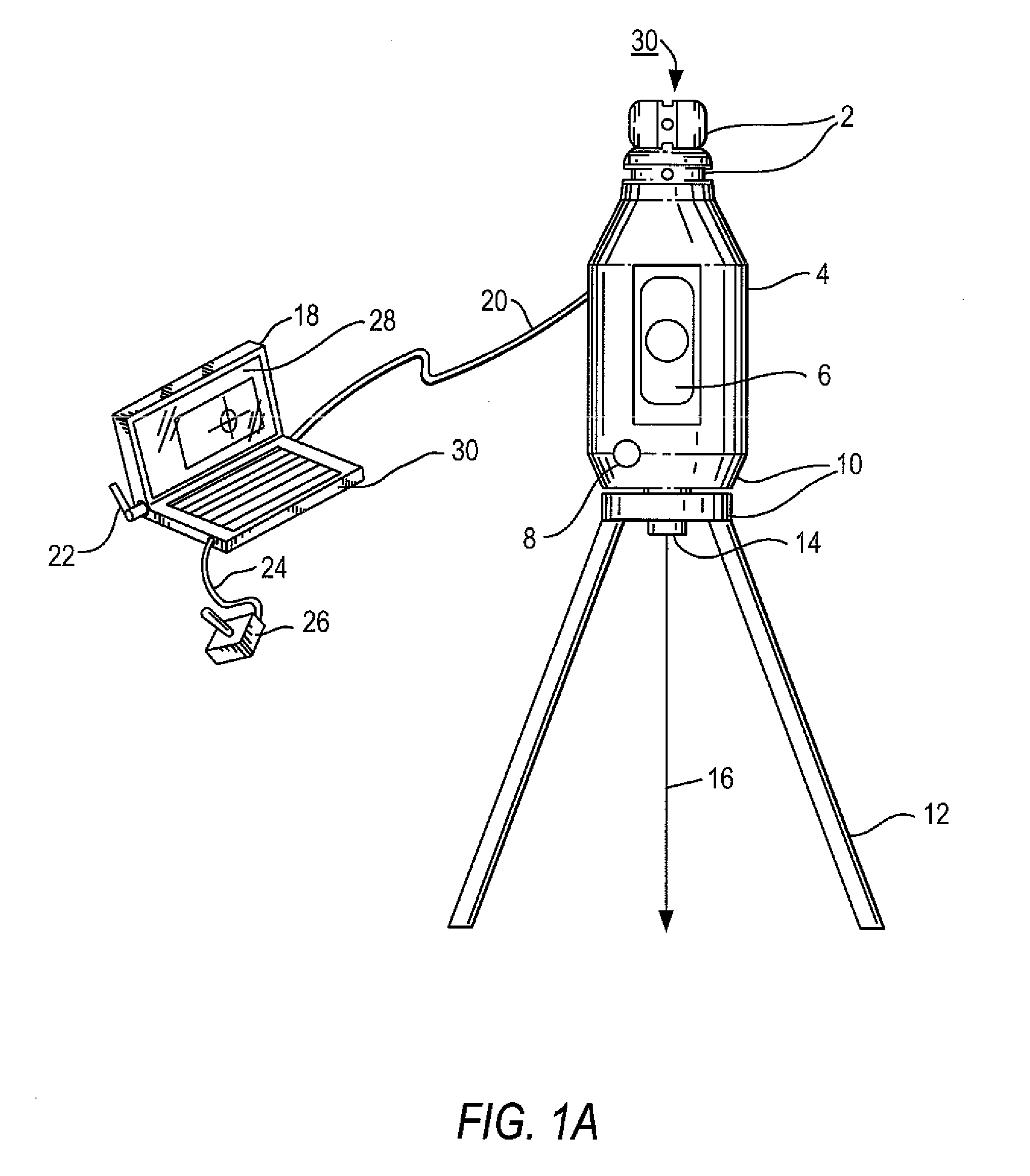

System and method for three-dimensional shape and size measurement

InactiveUS6968075B1Accurate measurementData augmentationData processing applicationsSpecial data processing applicationsComputer Aided DesignSize measurement

A method for three-dimensional shape and size measurement of a three-dimensional body surface comprising providing a three-dimensional scanner, providing a processor, providing a three-dimensional Computer Aided Design system, scanning in three dimensions with the three-dimensional scanner at least a portion of the three-dimensional body surface, creating a data file representative of the three-dimensional body surface, processing the data file with the processor, importing the data file into the three-dimensional Computer Aided Design System, employing the three-dimensional Computer Aided Design System relative to the data file to define and record three-dimensional measuring data relative to at least a portion of the three-dimensional body surface, A and employing the three-dimensional Computer Aided Design System to exploit the three-dimensional measuring data.

Owner:CHANG KURT C

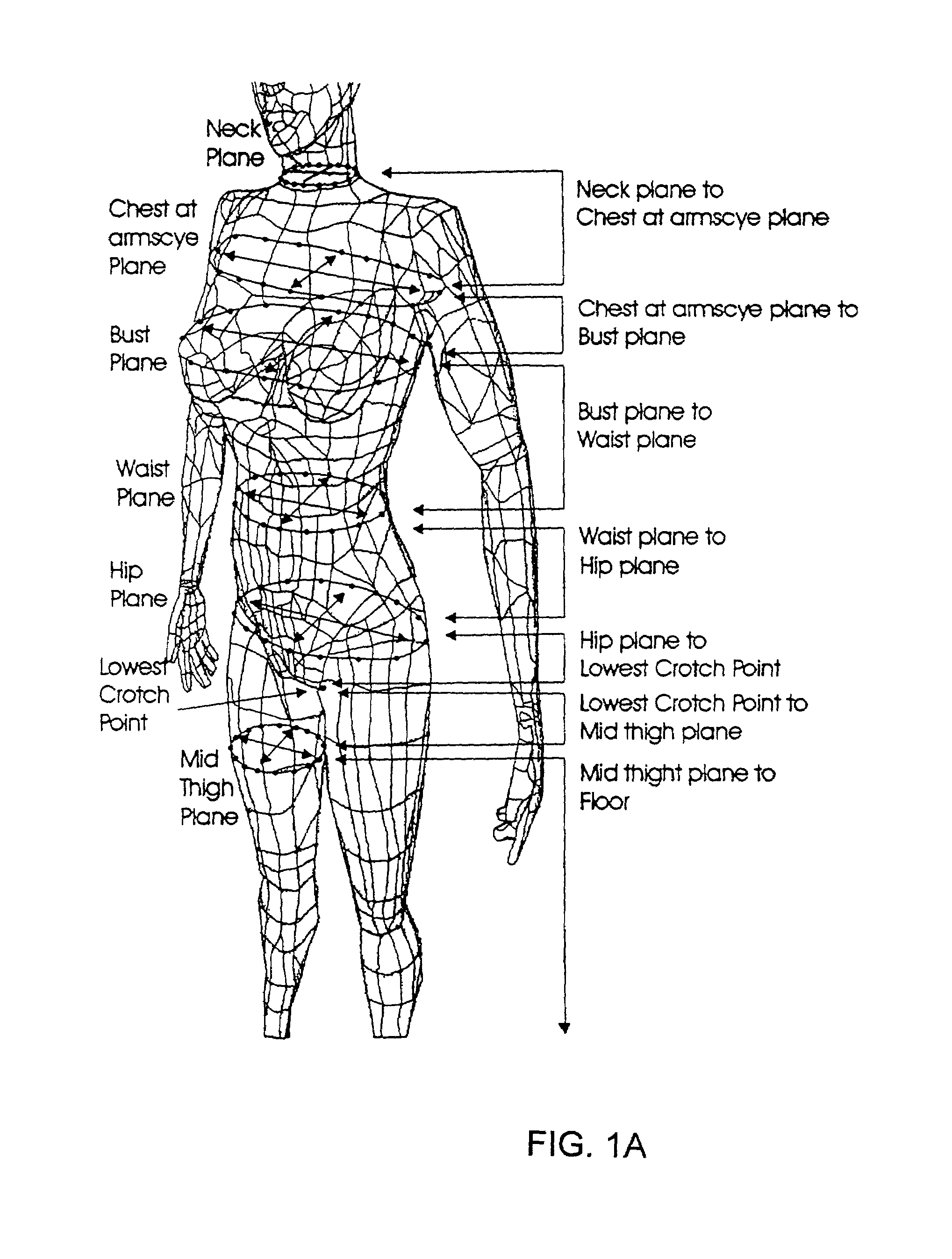

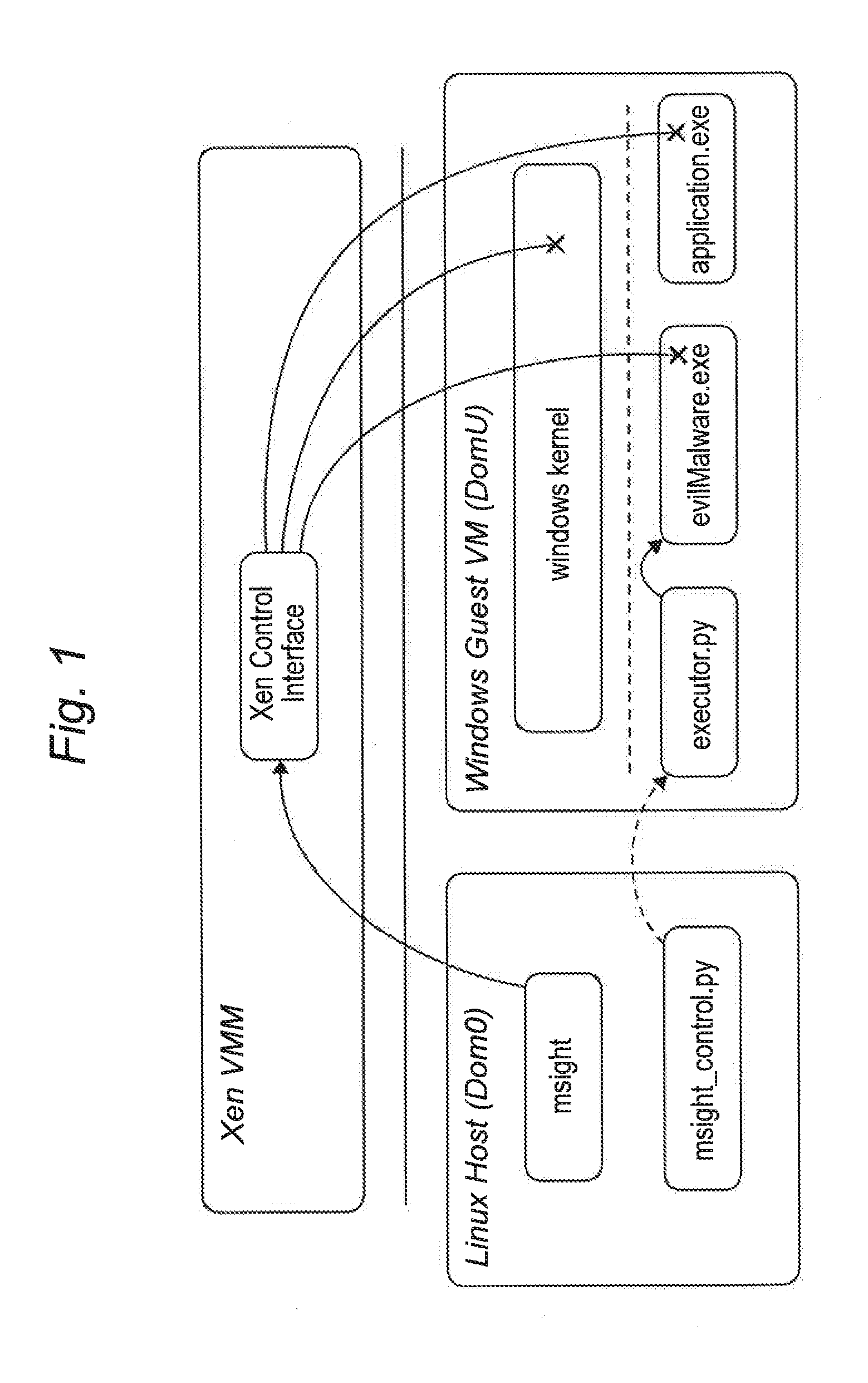

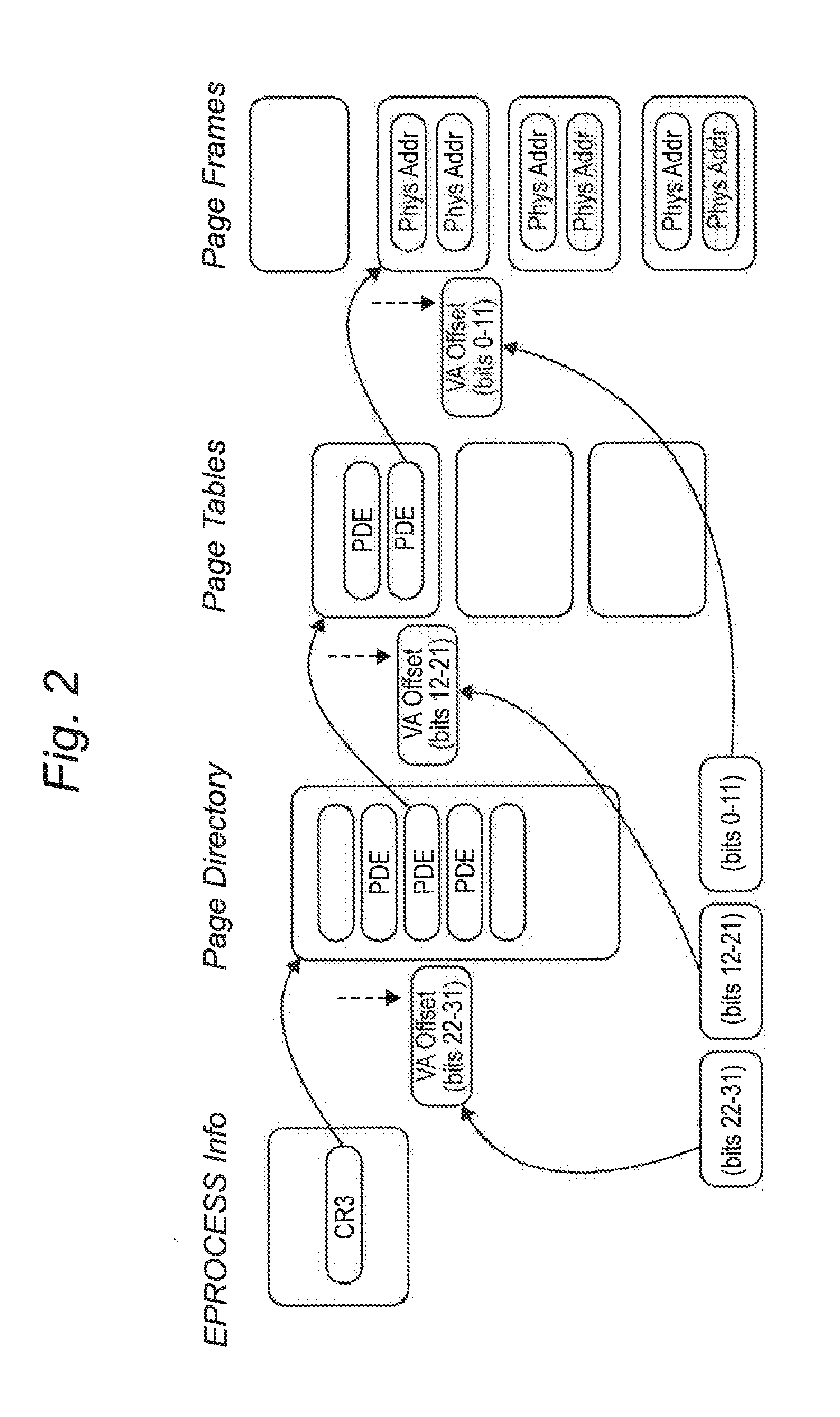

System and Method to Create a Number of Breakpoints in a Virtual Machine Via Virtual Machine Trapping Events

ActiveUS20140189687A1Accurate descriptionAvoid disadvantagesPlatform integrity maintainanceProgram/content distribution protectionVirtualizationVirtual machine

A system and method for dynamic software analysis operable to describe program behavior via instrumentation of virtualization events.

Owner:FIREEYE INC

System and method capable of navigating and/or mapping any multi-dimensional space

InactiveUS20110043515A1Facilitate transitionEasy transitionActive open surveying meansVehicle position/course/altitude controlData miningGraphics

A method and system that allows a user to perform automatic study, layout and verification of a multidimensional space in real time where the study can be displayed graphically, in 3-dimensions for example, via a handheld unit allowing the system to guide and / or navigate the user throughout the multidimensional space as the automatic study and / or layout is being performed.

Owner:STATHIS SAM

Systems and methods for assessing the risk of a financial transaction using biometric information

ActiveUS20050125339A1Accurate descriptionAccurate transactionFinancePayment architectureConfidence metricFinancial transaction

Systems and methods are described for better assessing risk associated with cashing second-party checks and other negotiable instruments by using biometric information obtained from an individual who presents a check or other negotiable instrument in a check-cashing transaction. In various embodiments, the obtained biometric information may be compared with stored biometric information in order to enhance confidence in the accurate identification of the check presenter. In various embodiments, a gradated biometric risk score, based at least in part on the comparison, may be generated for the check-cashing transaction. In various embodiments, the biometric risk score may be combined with risk scores that are descriptive of other aspects of the check-cashing transaction to calculate a risk score for the transaction as a whole. In some embodiments, the risk scores may be used to generate an accept / decline recommendation for the transaction as a whole.

Owner:FIRST DATA

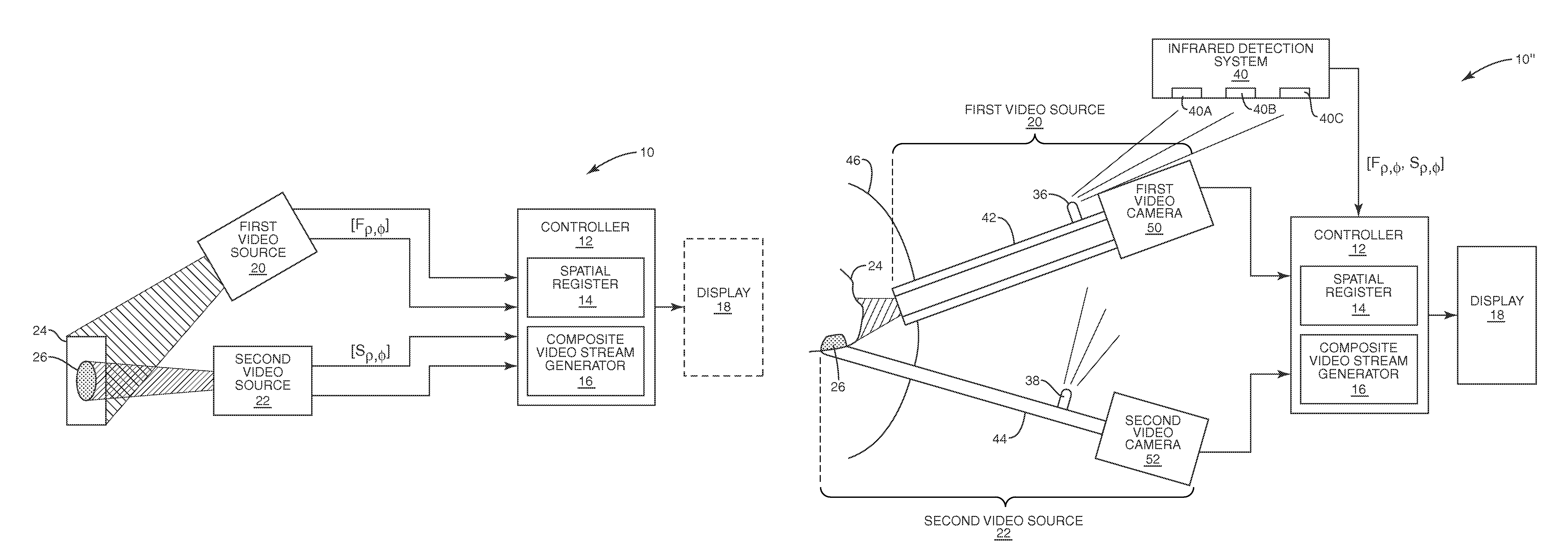

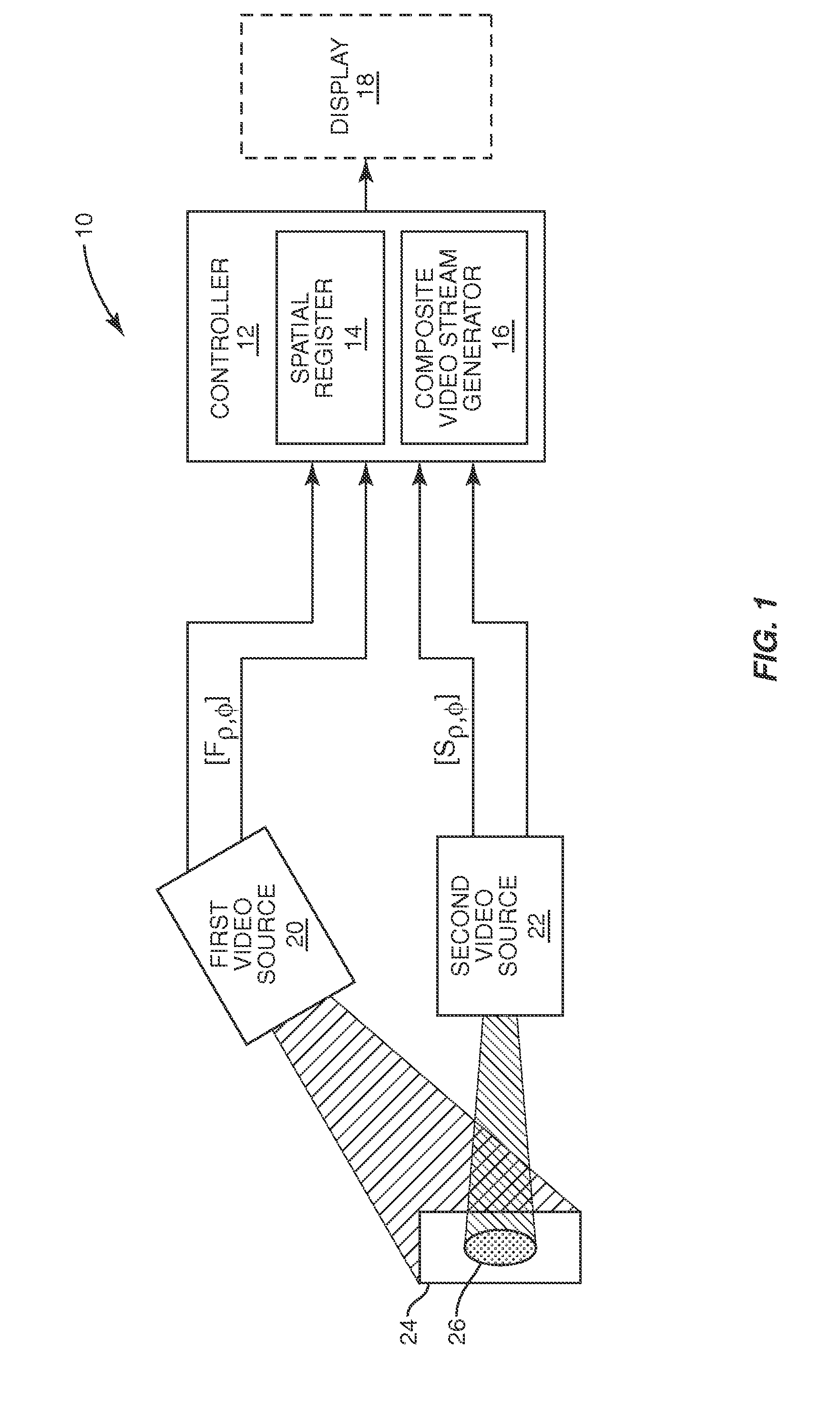

System and method of providing real-time dynamic imagery of a medical procedure site using multiple modalities

ActiveUS7728868B2No delayEfficient procedureUltrasonic/sonic/infrasonic diagnosticsGeometric image transformationDiagnostic Radiology ModalityComputer science

A system and method of providing composite real-time dynamic imagery of a medical procedure site from multiple modalities which continuously and immediately depicts the current state and condition of the medical procedure site synchronously with respect to each modality and without undue latency is disclosed. The composite real-time dynamic imagery may be provided by spatially registering multiple real-time dynamic video streams from the multiple modalities to each other. Spatially registering the multiple real-time dynamic video streams to each other may provide a continuous and immediate depiction of the medical procedure site with an unobstructed and detailed view of a region of interest at the medical procedure site at multiple depths. As such, a surgeon, or other medical practitioner, may view a single, accurate, and current composite real-time dynamic imagery of a region of interest at the medical procedure site as he / she performs a medical procedure, and thereby, may properly and effectively implement the medical procedure.

Owner:INNEROPTIC TECH

Systems and methods for assessing the risk of financial transaction using geographic-related information

InactiveUS20050125350A1Accurate descriptionSlow processComplete banking machinesFinancePosition dependentCheque

Systems and methods are described for better assessing risk associated with cashing second-party checks and other negotiable instruments. The systems and methods make use of location-related information about an issuer of a second-party check being presented for cashing in order to better assess the legitimacy and cashability of the check. In various embodiments, information about the proximity of the check issuer to the check cashing location is used to enhance risk assessment of the check item. In various embodiments, location-based information about a check may be expressed as a gradated location-based risk score. In various embodiments, the location-based risk score may be combined with risk scores that are descriptive of other aspects of a check cashing transaction to calculate a risk score for the transaction as a whole. In some embodiments, the risk scores may be used to generate an accept / decline recommendation for the transaction.

Owner:FIRST DATA

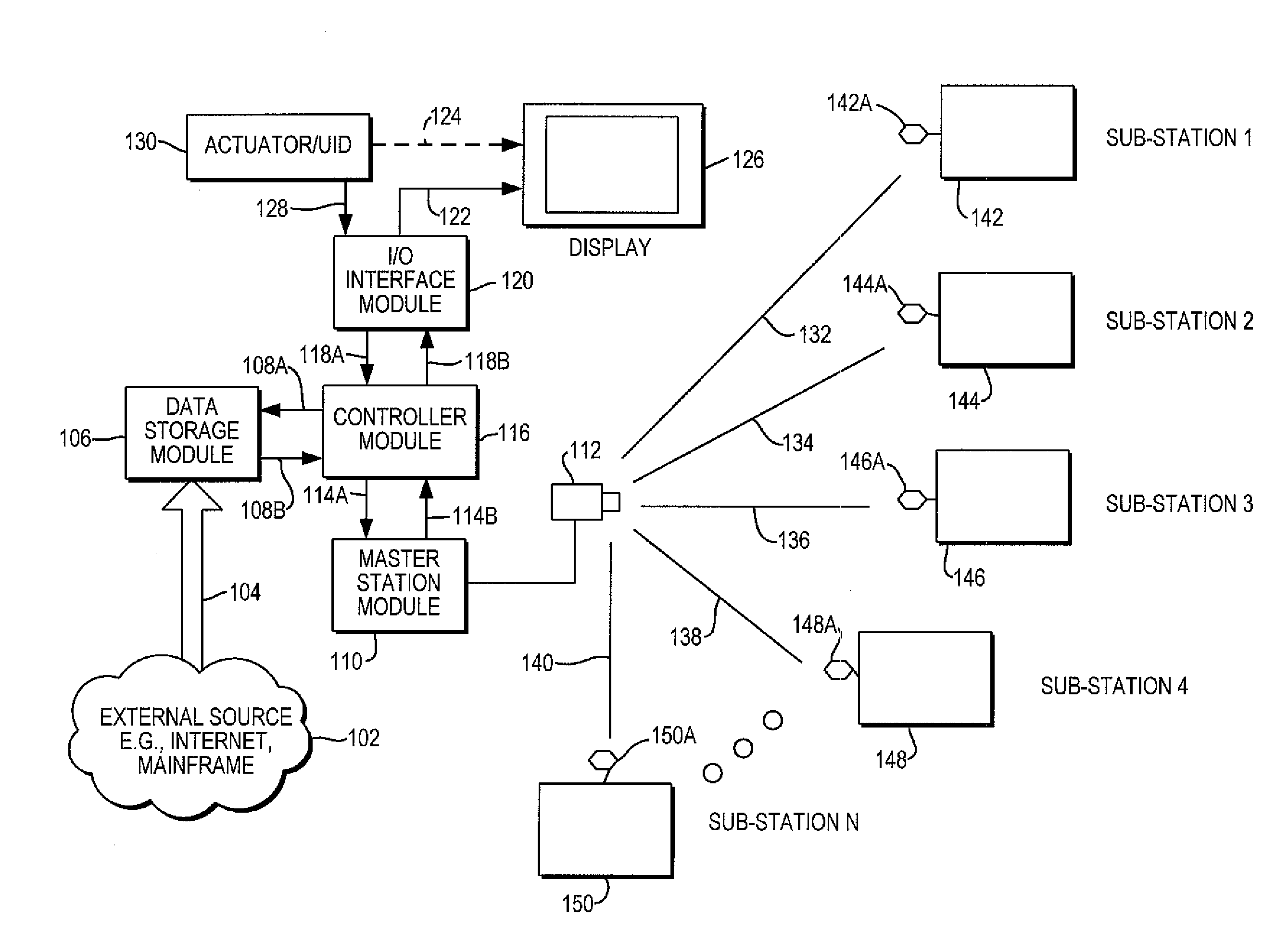

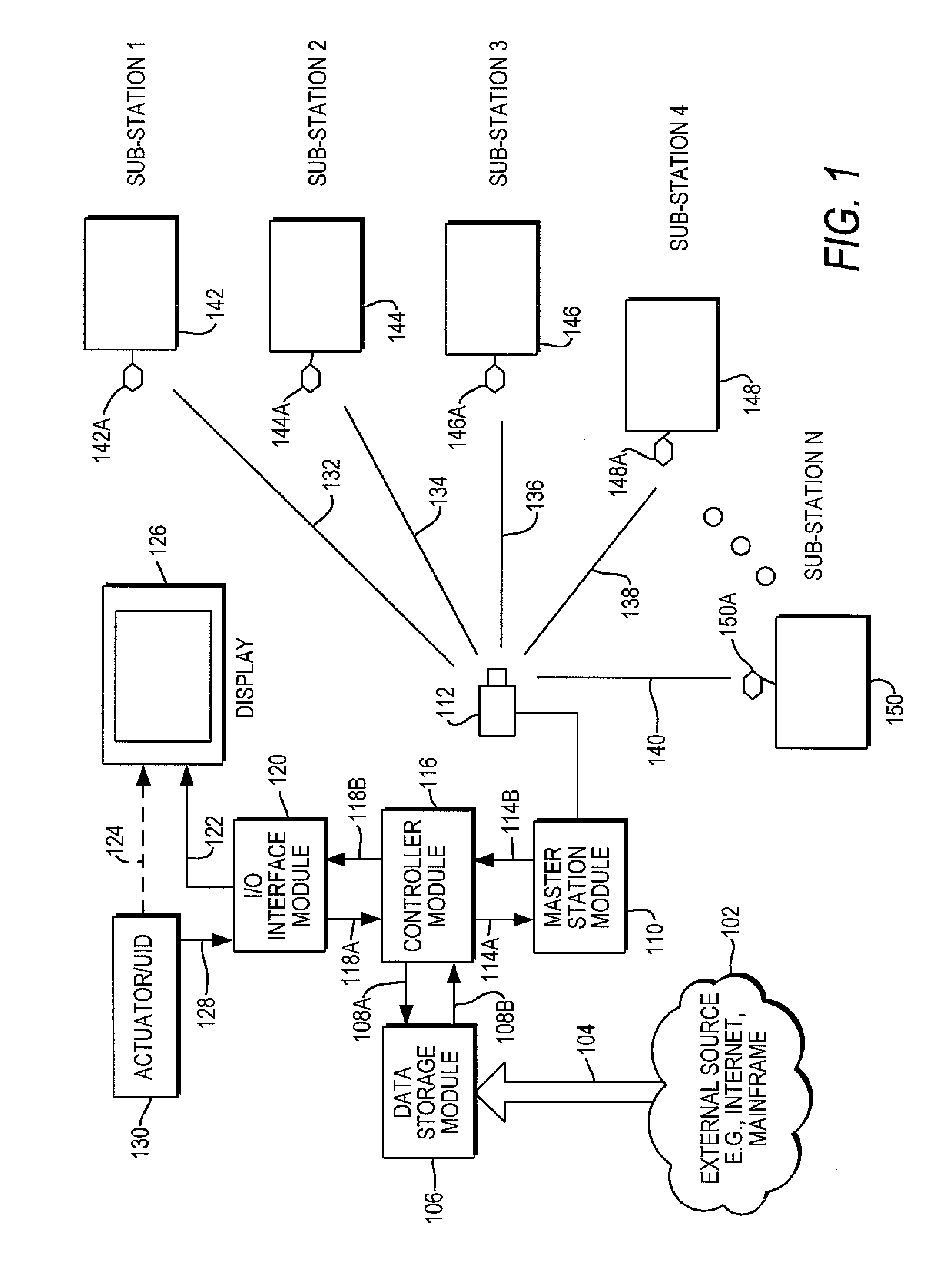

Distributed Processing

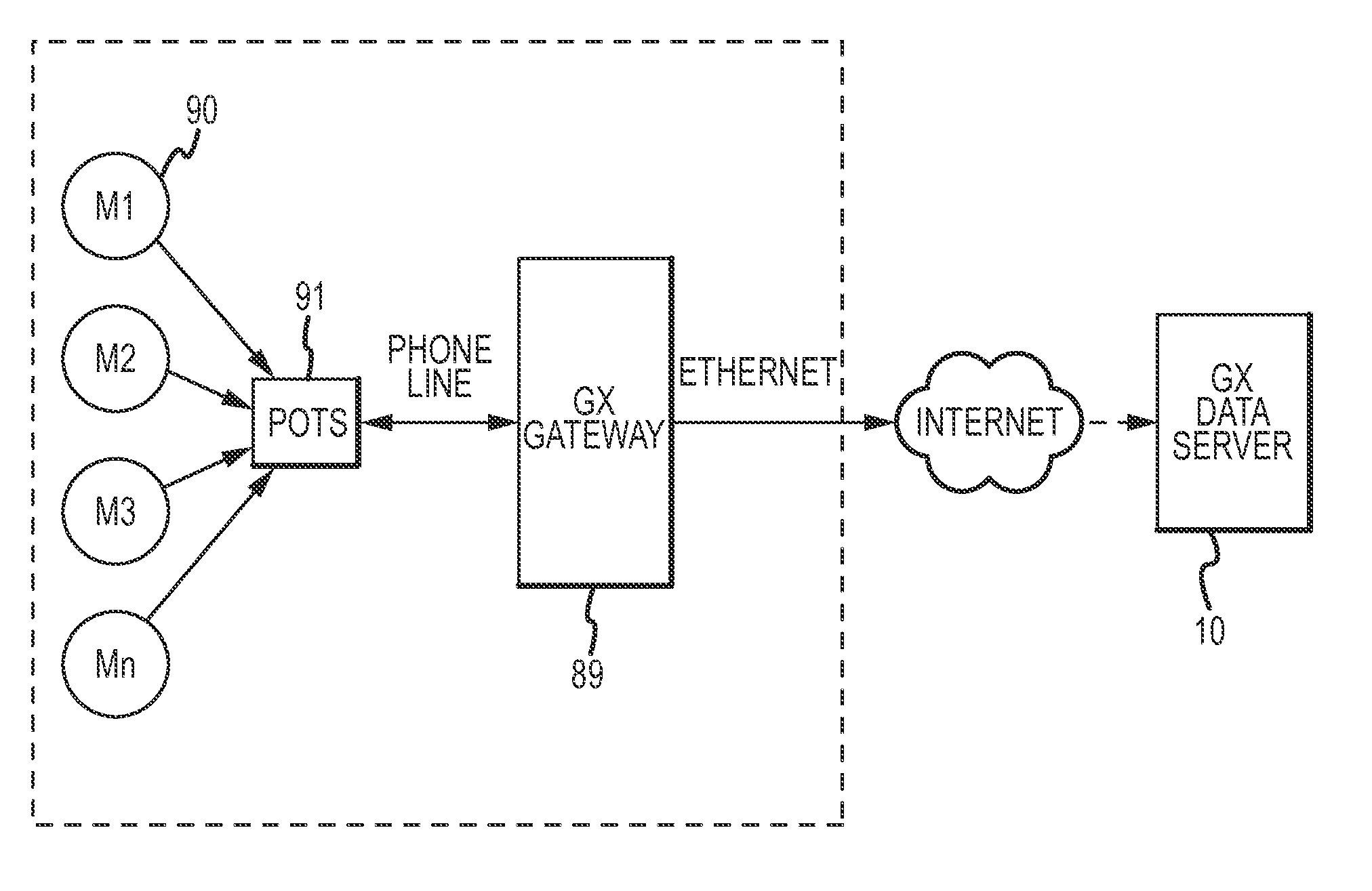

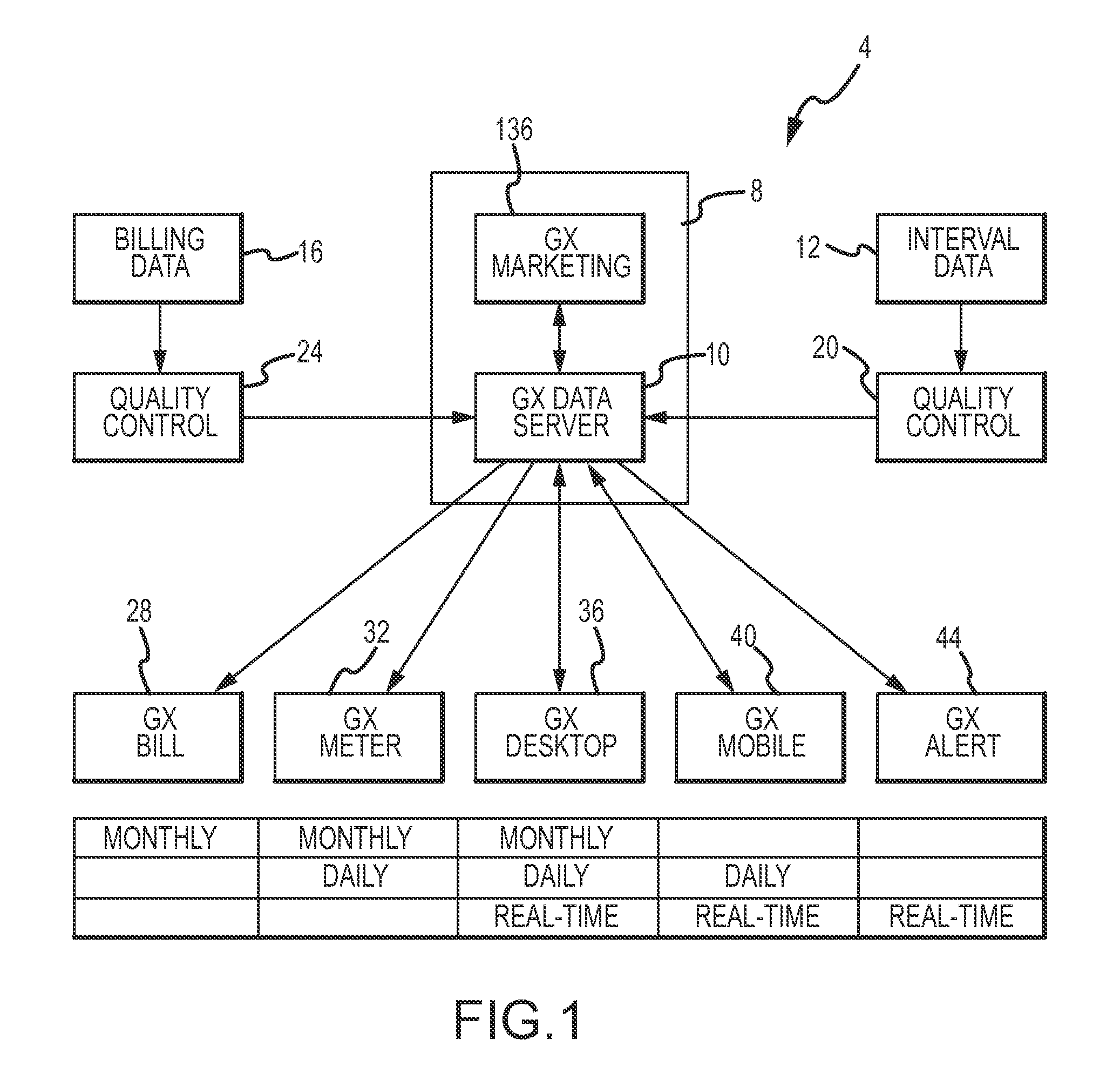

InactiveUS20100064001A1Easy to useImprove environmental performanceMultiple digital computer combinationsBilling/invoicingElectronic formHandling system

A distributed processing system for acquiring utility usage information from customer facilities, processing the utility usage information, and delivering the utility usage information in formats that facilitate understanding by end-users. The distributed processing system may include a server system that may store utility usage information, generate real-time alert messages, and create spreadsheet report attachments that may be pushed to end-users. Some of the spreadsheet reports may include a number of navigations buttons allowing a user to toggle between various tools that analyze utility usage information.

Owner:POWER TAKEOFF

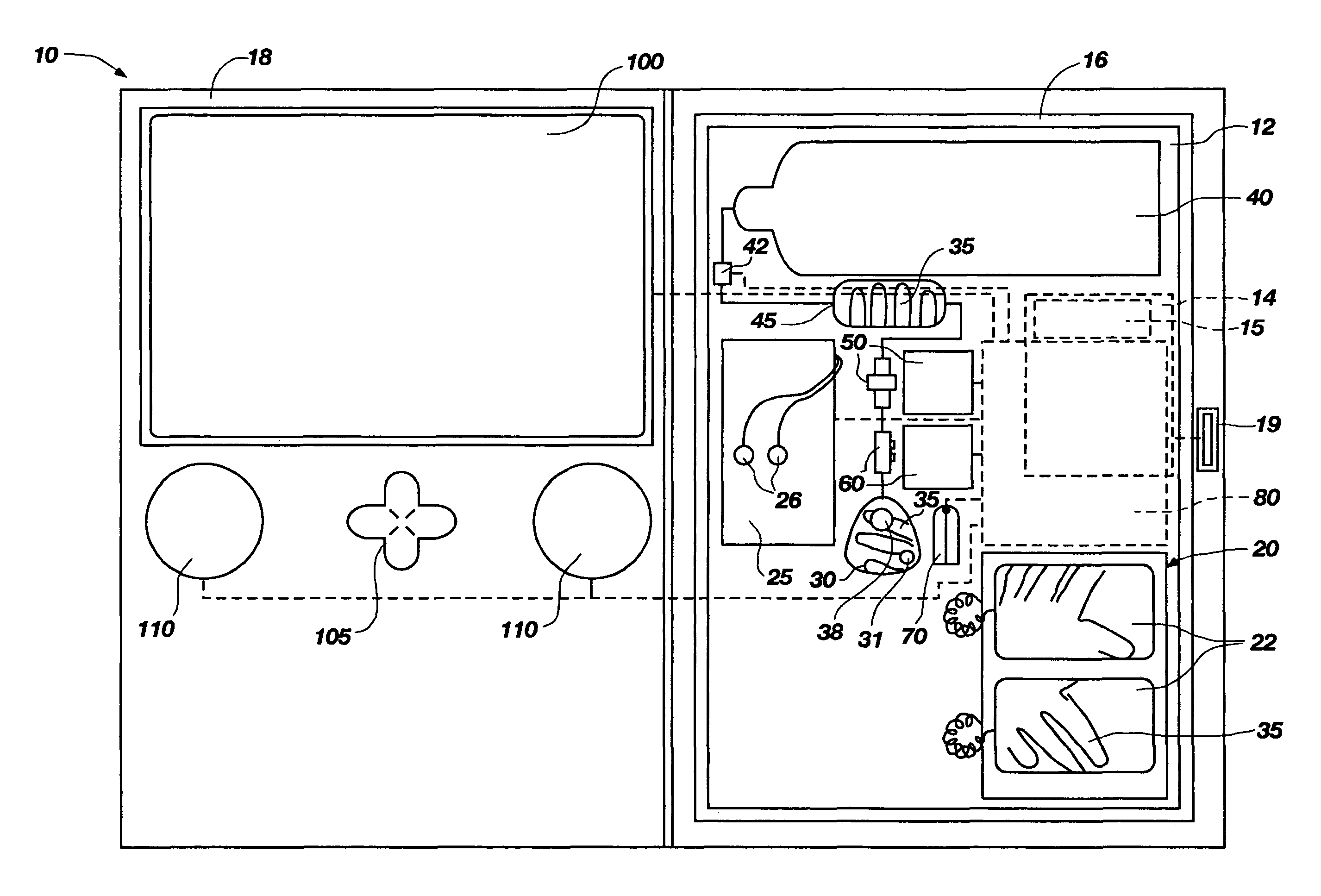

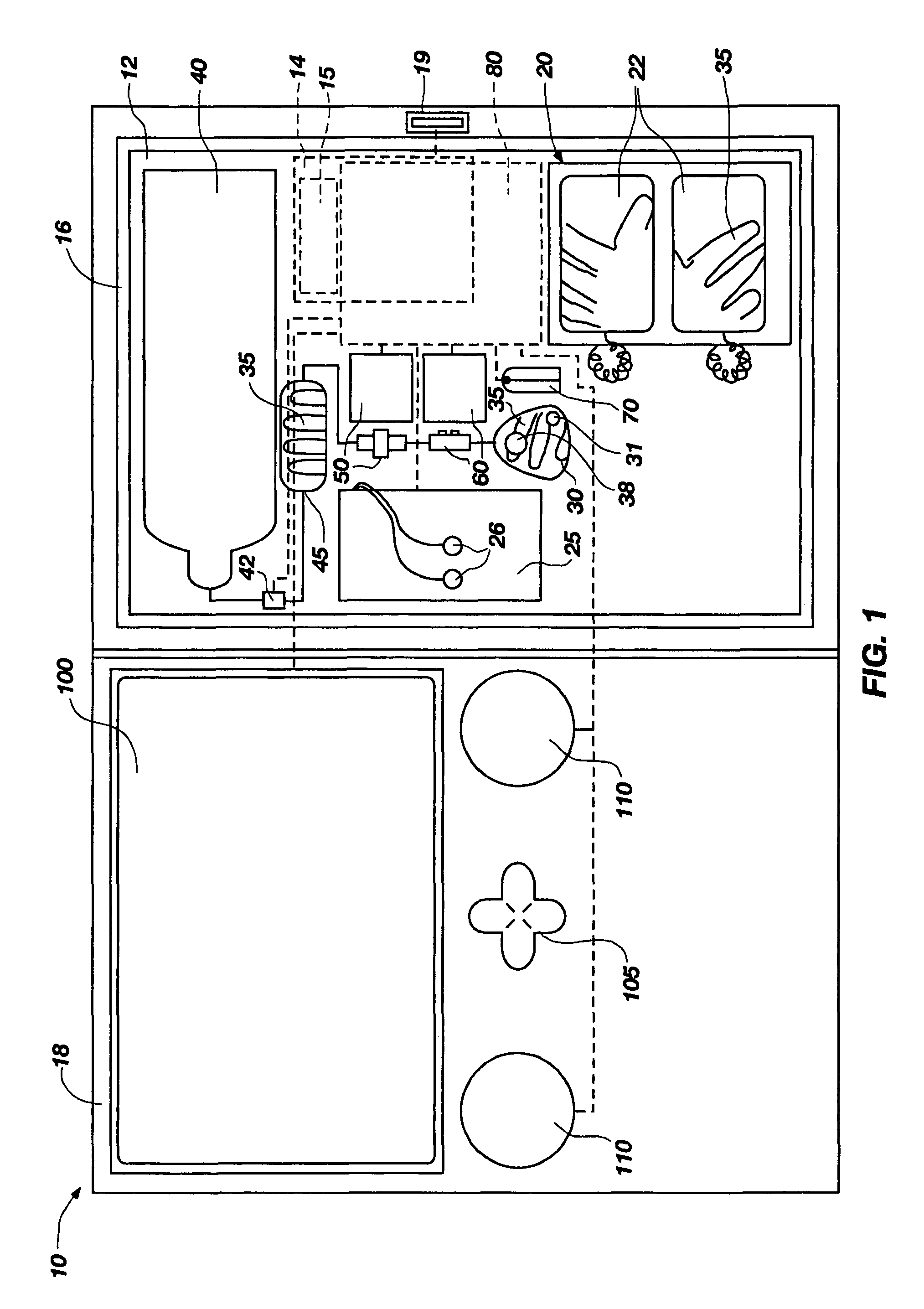

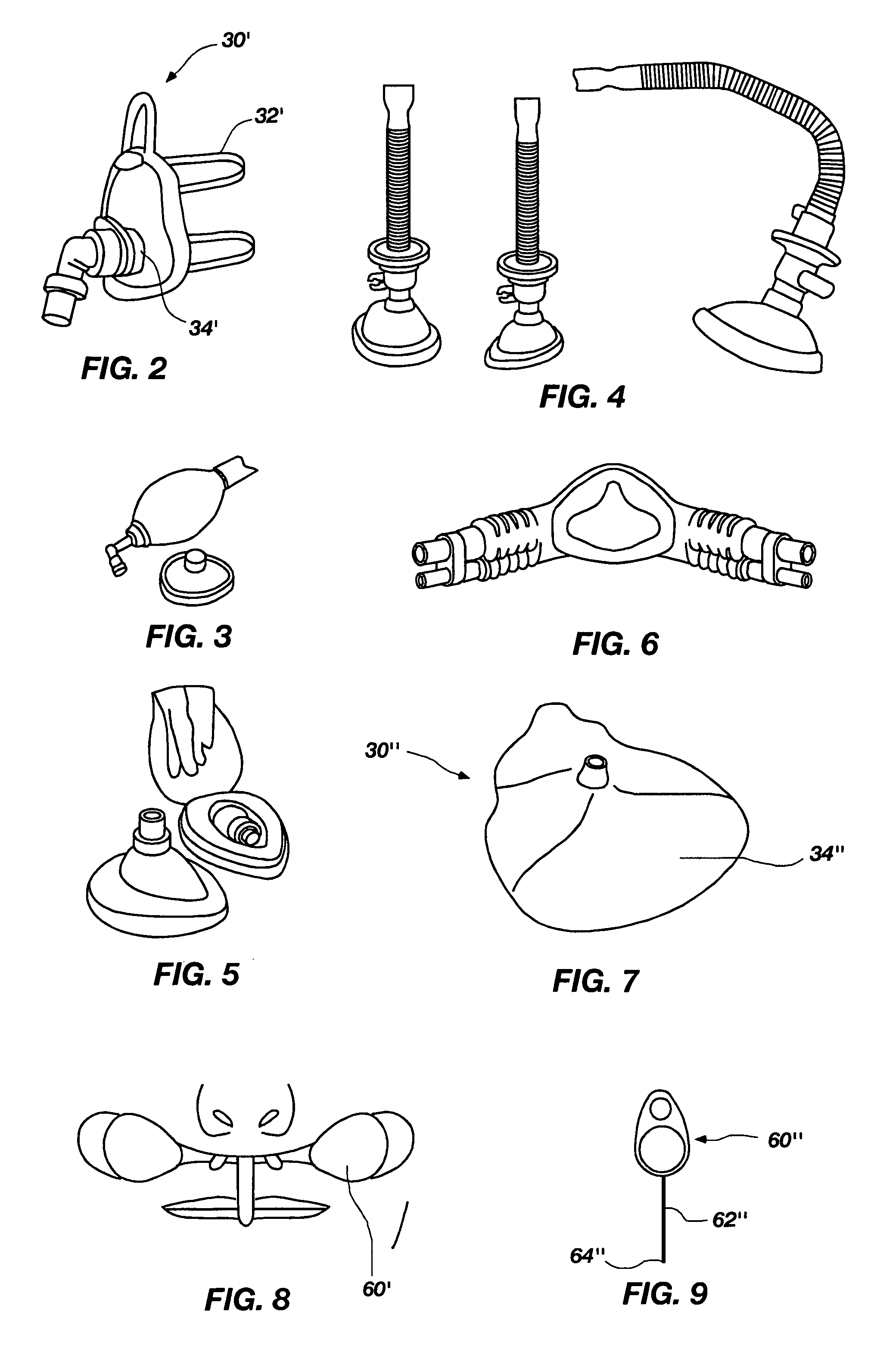

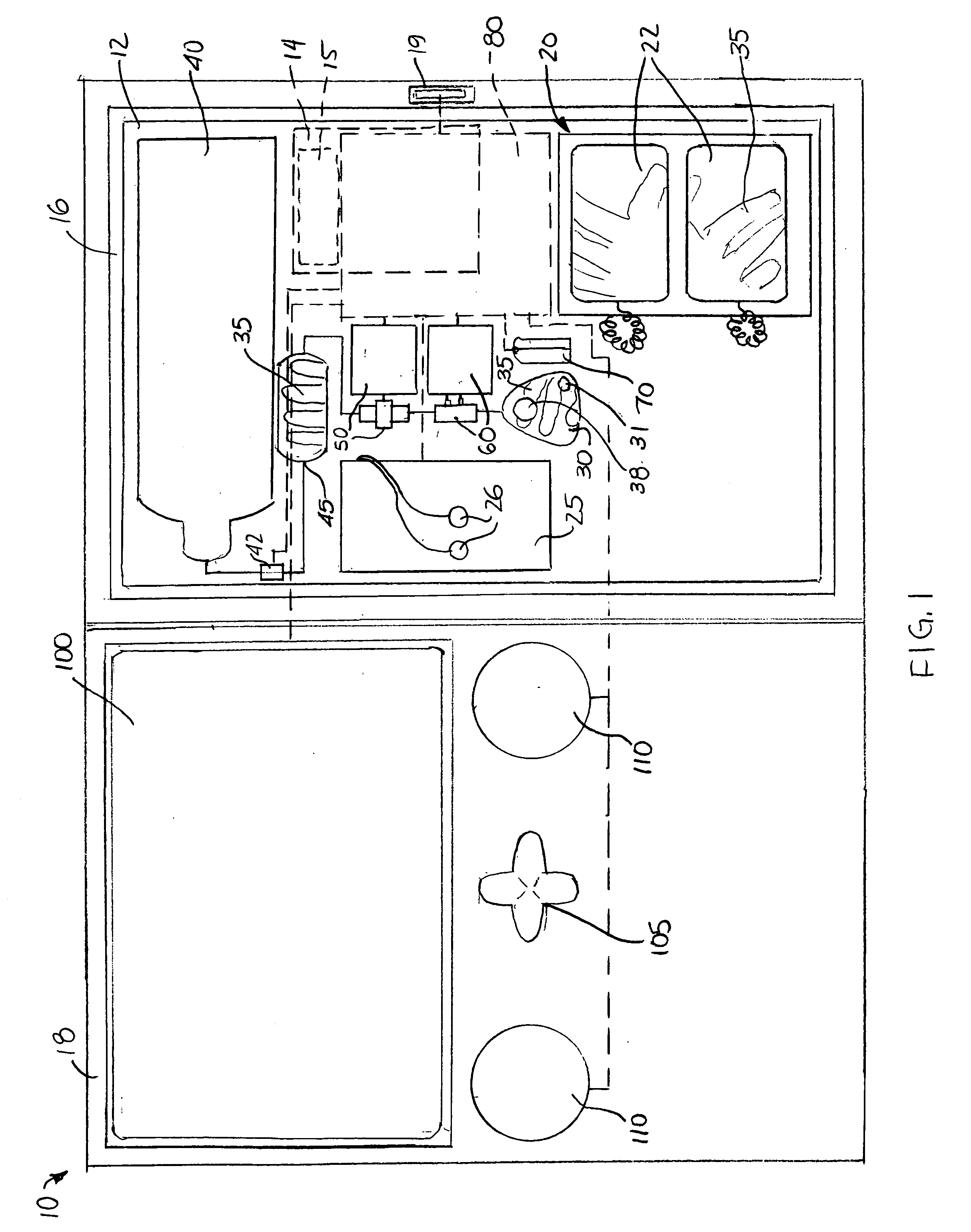

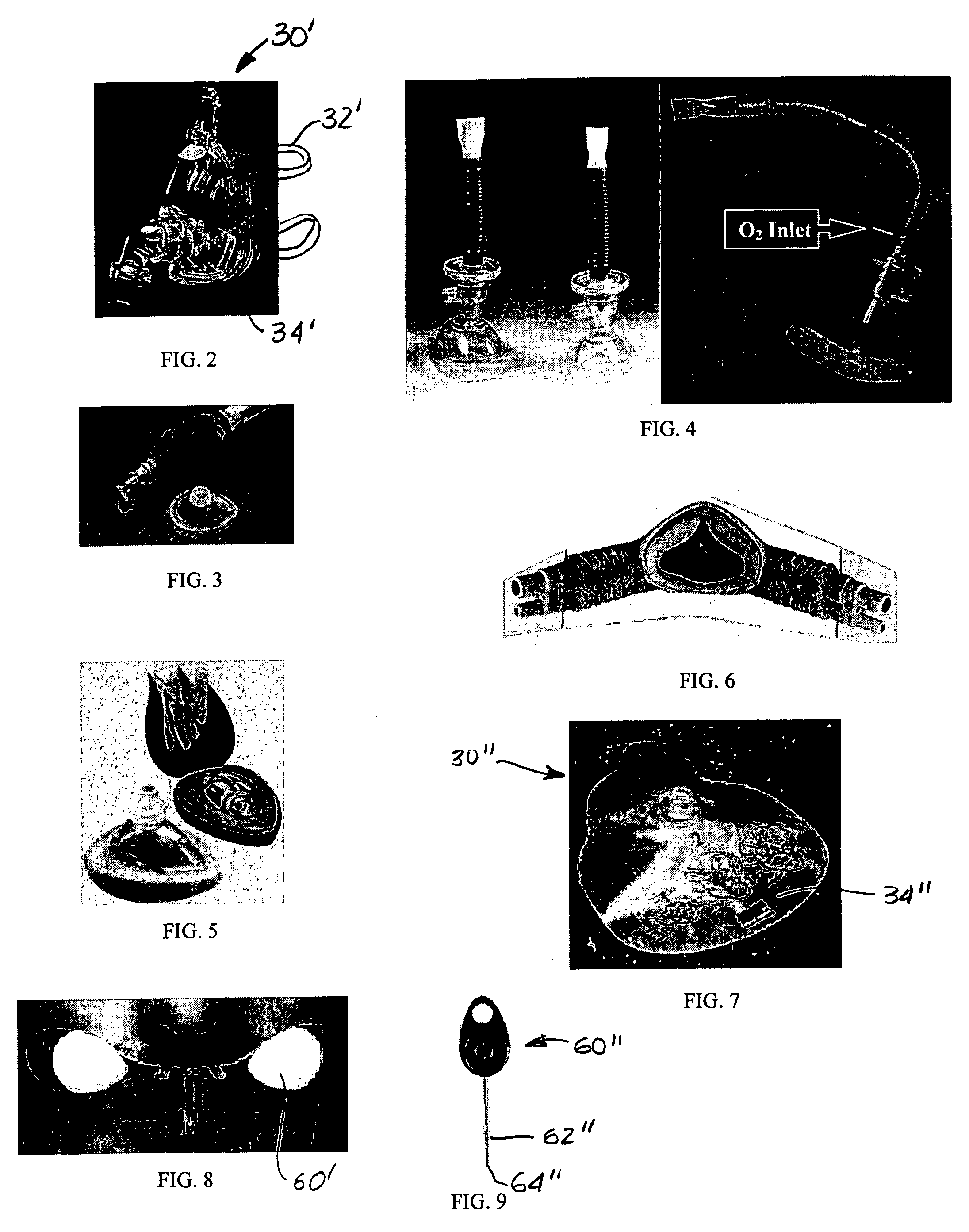

System for providing emergency medical care with real-time instructions and associated methods

InactiveUS7774060B2Optimize (Minimize) the amount of time it takes a responderRespiratorsElectrocardiographyGraphicsBasic life support

A basic life support system (BLSS) includes a processing element and an output element, such as a display screen or an audio output element, for providing an individual with real-time instructions on providing emergency medical care to a patient until paramedics or other healthcare professionals arrive to take over care for the patient. The instructions may be provided as graphics, including animations, as text, audibly, or as a combination of visible and audible elements. The BLSS may be configured for providing emergency medical care to individuals who have suffered from ventricular fibrillation. Accordingly, the BLSS may also include a defibrillation apparatus, an air or oxygen supply, a respiratory interface, one or more sensors, or a combination thereof.

Owner:UNIV OF UTAH RES FOUND +1

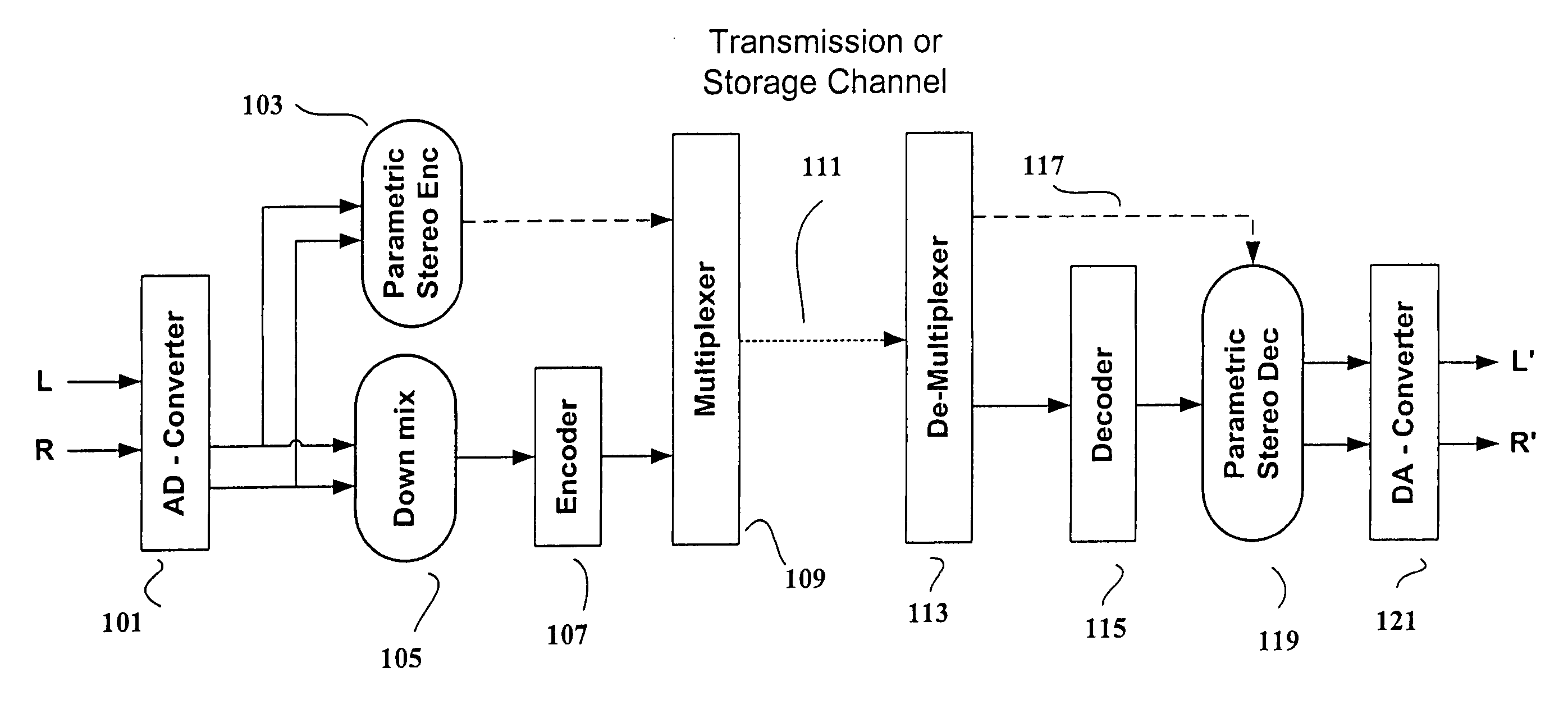

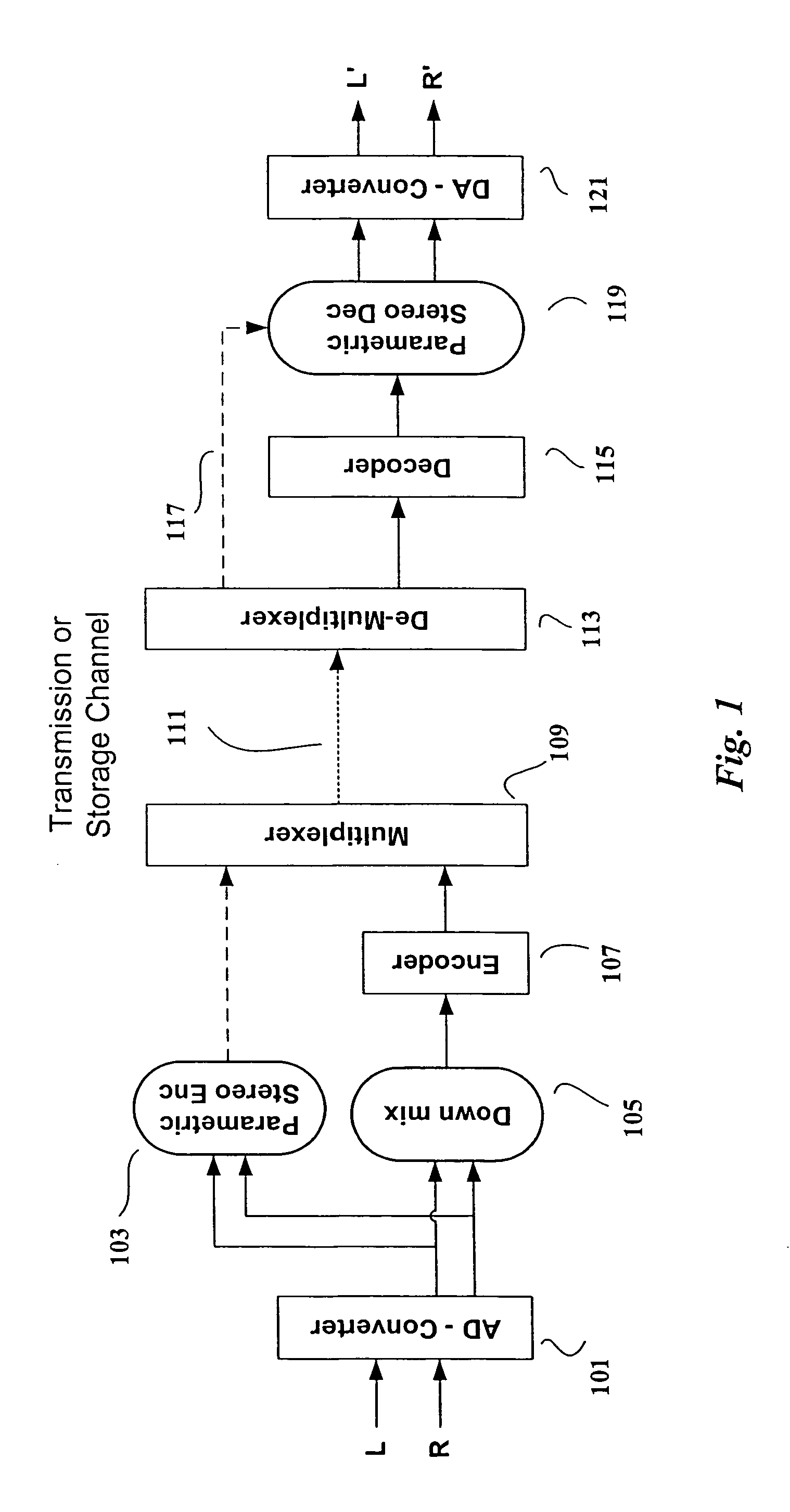

Efficient and scalable parametric stereo coding for low bitrate applications

ActiveUS20050053242A1Reduce riskGuaranteed normal transmissionSpeech analysisPseudo-stereo systemsVocal tractStereo image

The present invention provides improvements to prior art audio codecs that generate a stereo-illusion through post-processing of a received mono signal. These improvements are accomplished by extraction of stereo-image describing parameters at the encoder side, which are transmitted and subsequently used for control of a stereo generator at the decoder side. Furthermore, the invention bridges the gap between simple pseudo-stereo methods, and current methods of true stereo-coding, by using a new form of parametric stereo coding. A stereo-balance parameter is introduced, which enables more advanced stereo modes, and in addition forms the basis of a new method of stereo-coding of spectral envelopes, of particular use in systems where guided HFR (High Frequency Reconstruction) is employed. As a special case, the application of this stereo-coding scheme in scalable HFR-based codecs is described.

Owner:DOLBY INT AB

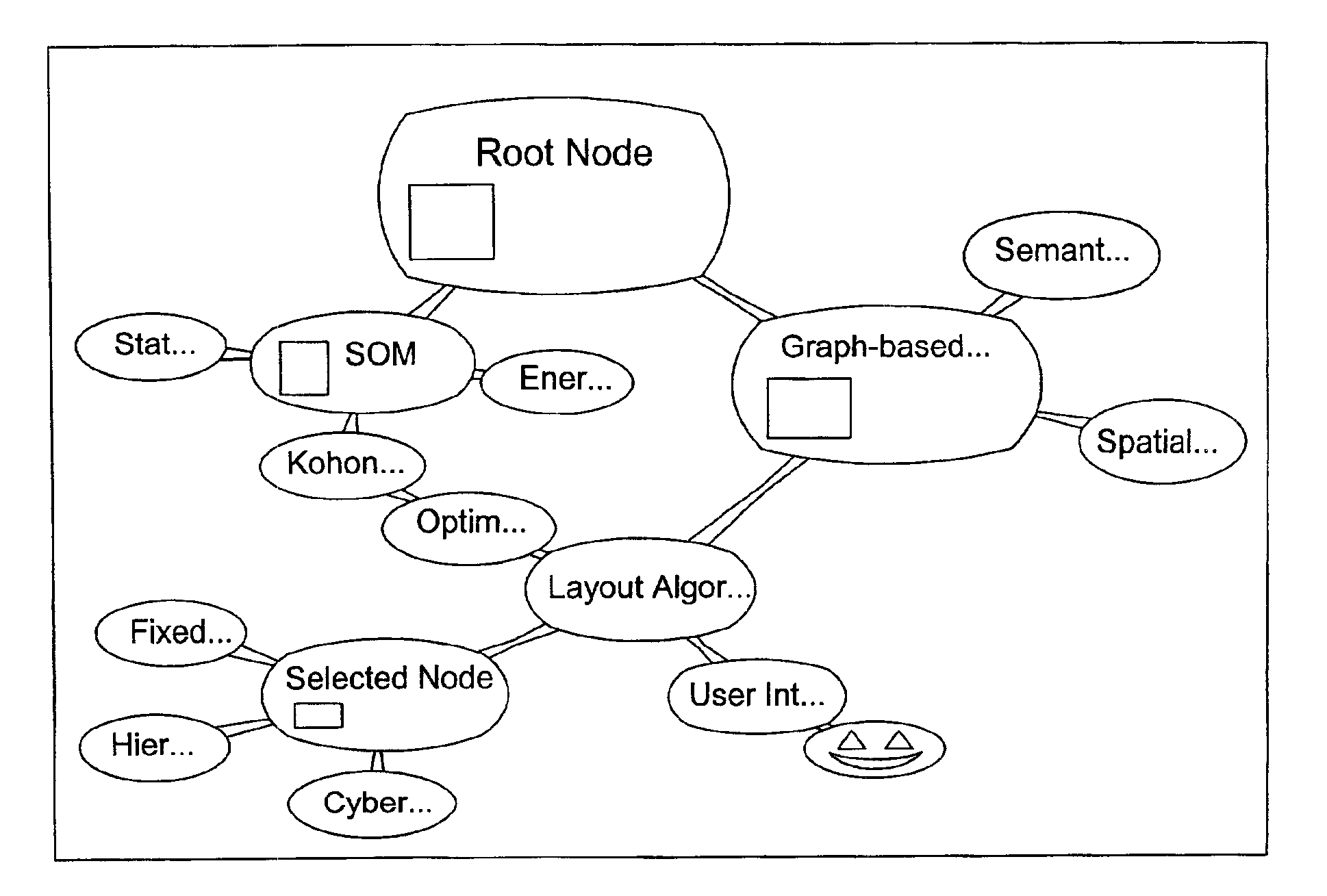

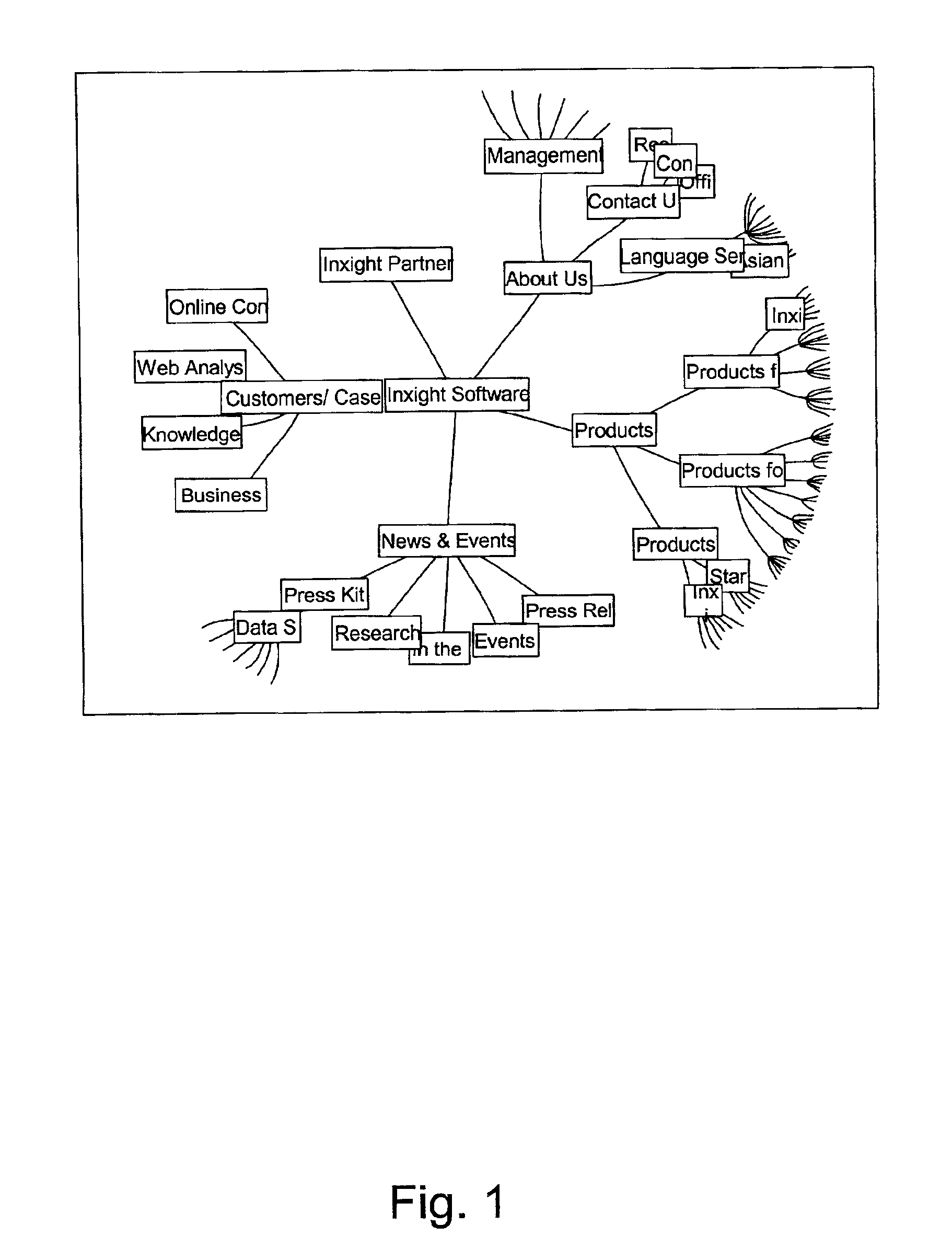

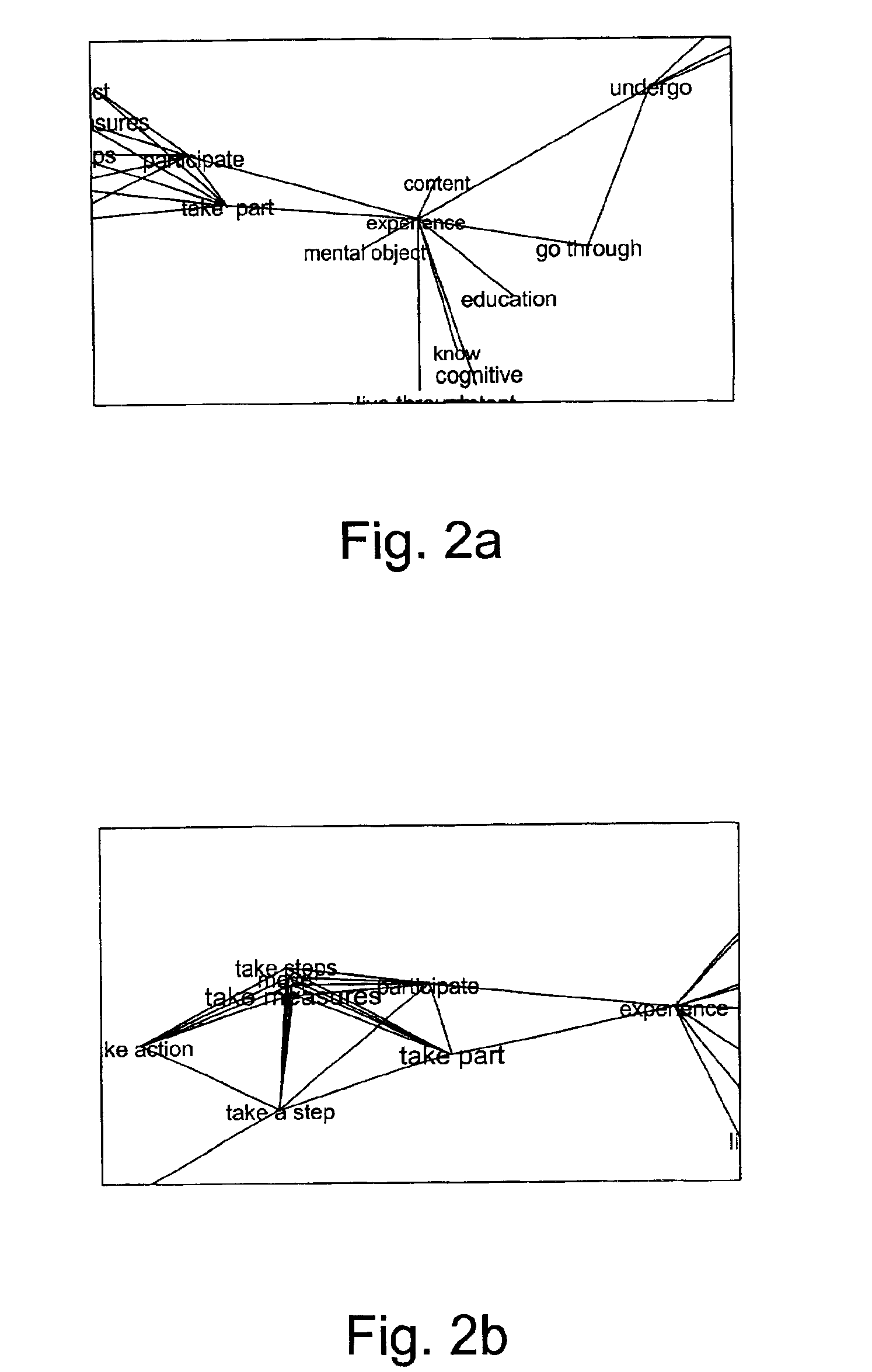

Method of navigating a collection of interconnected nodes

InactiveUS6931604B2Display moreAccurate descriptionDrawing from basic elementsDigital output to display deviceGraphicsTheoretical computer science

A method and apparatus for organizing and processing interconnected pieces of information (“nodes”) using a digital computer is disclosed. Each node has elements that may be text, images, audio, video, and other computer programs. A graph-based user interface presents the individual nodes in spatial arrangements that reflect the relationships among the nodes. User interaction indicating interest in a particular node results in an increase in the “activation” of that node. This leads to an increase in the size of the presentation of that node, as well as an increase in the size of the presentation of closely related nodes. The result is a unique user interaction paradigm that allows for intuitive traversal of complex collections of nodes.

Owner:LANE DEREK GRAHAM

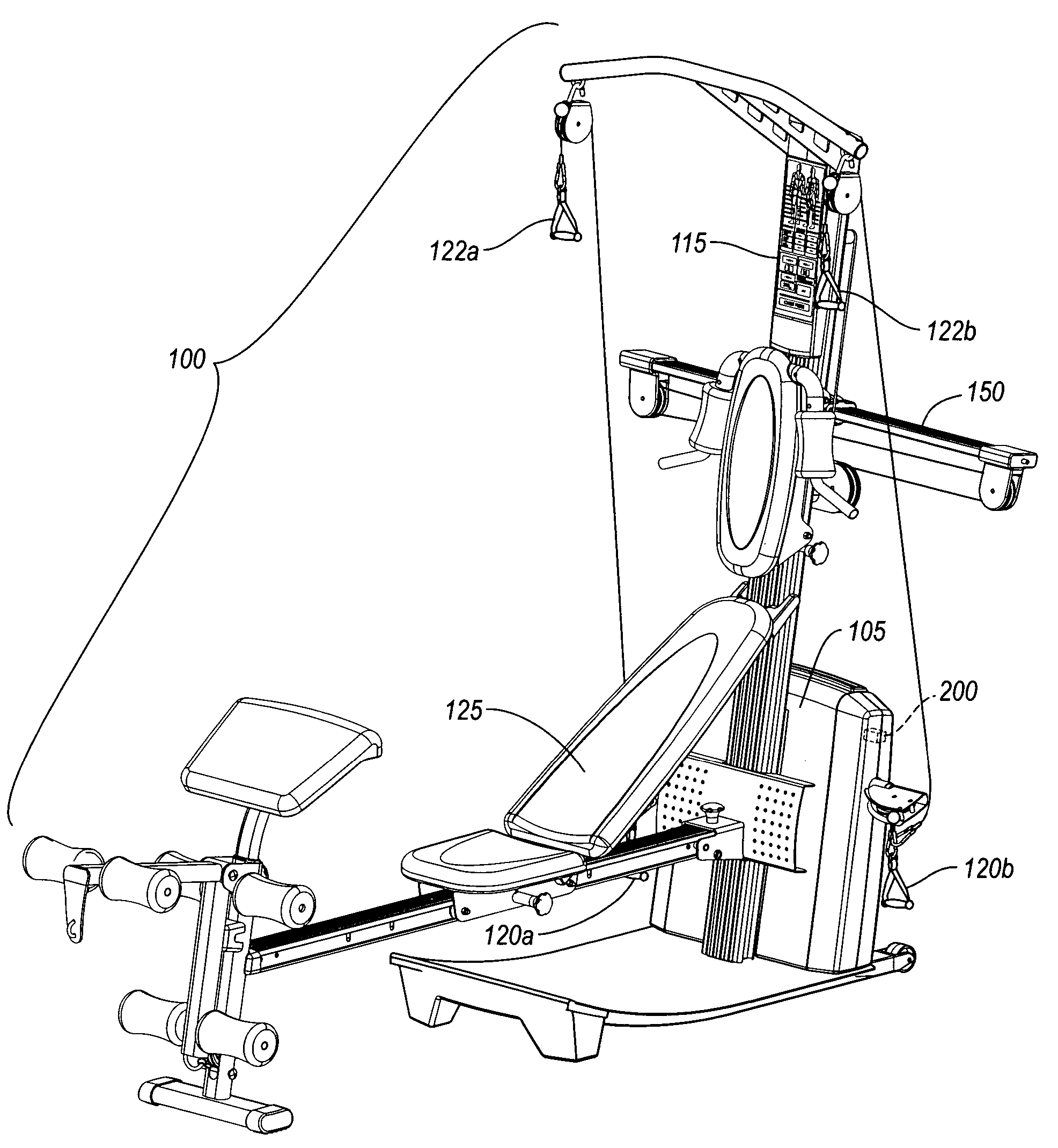

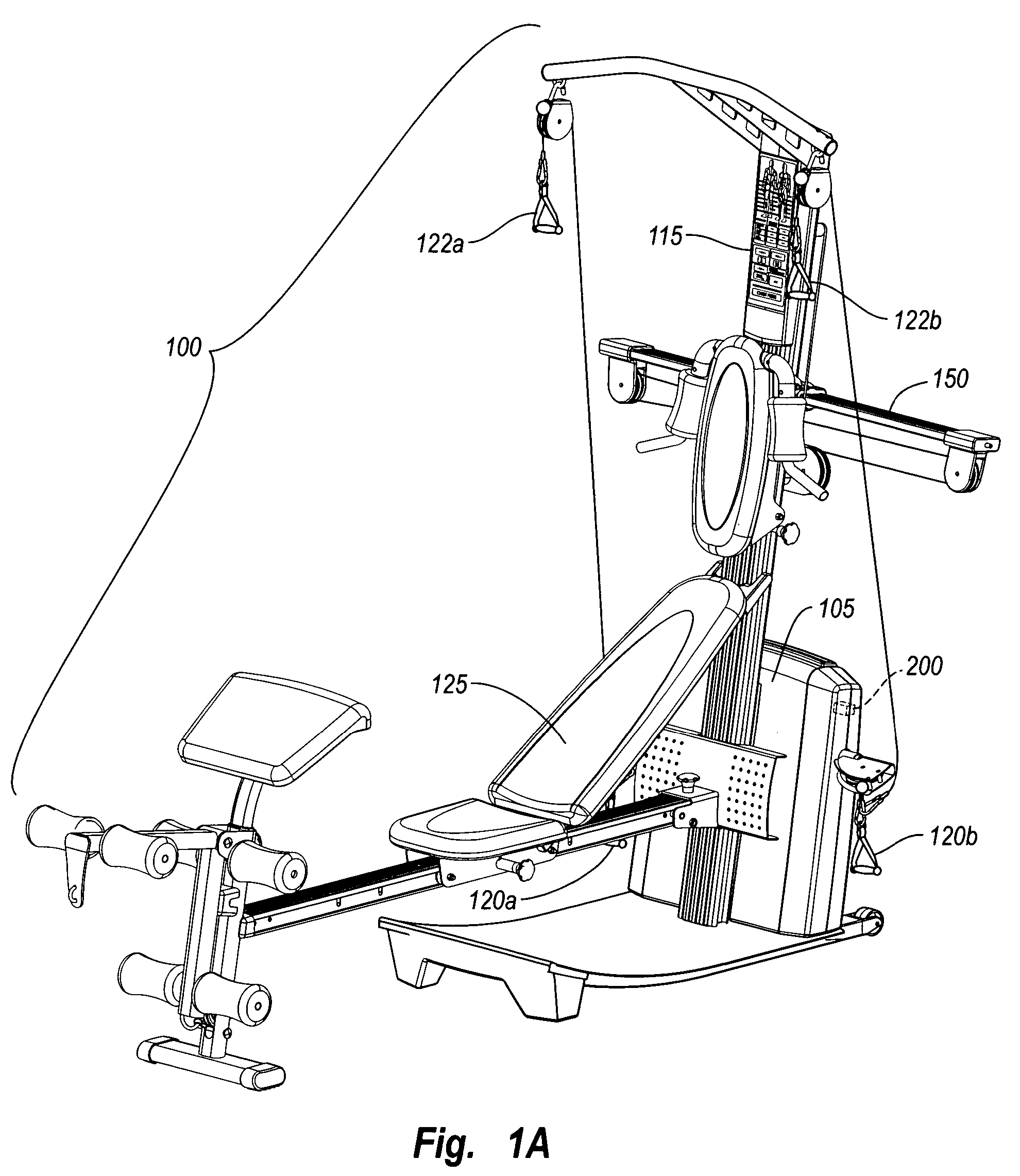

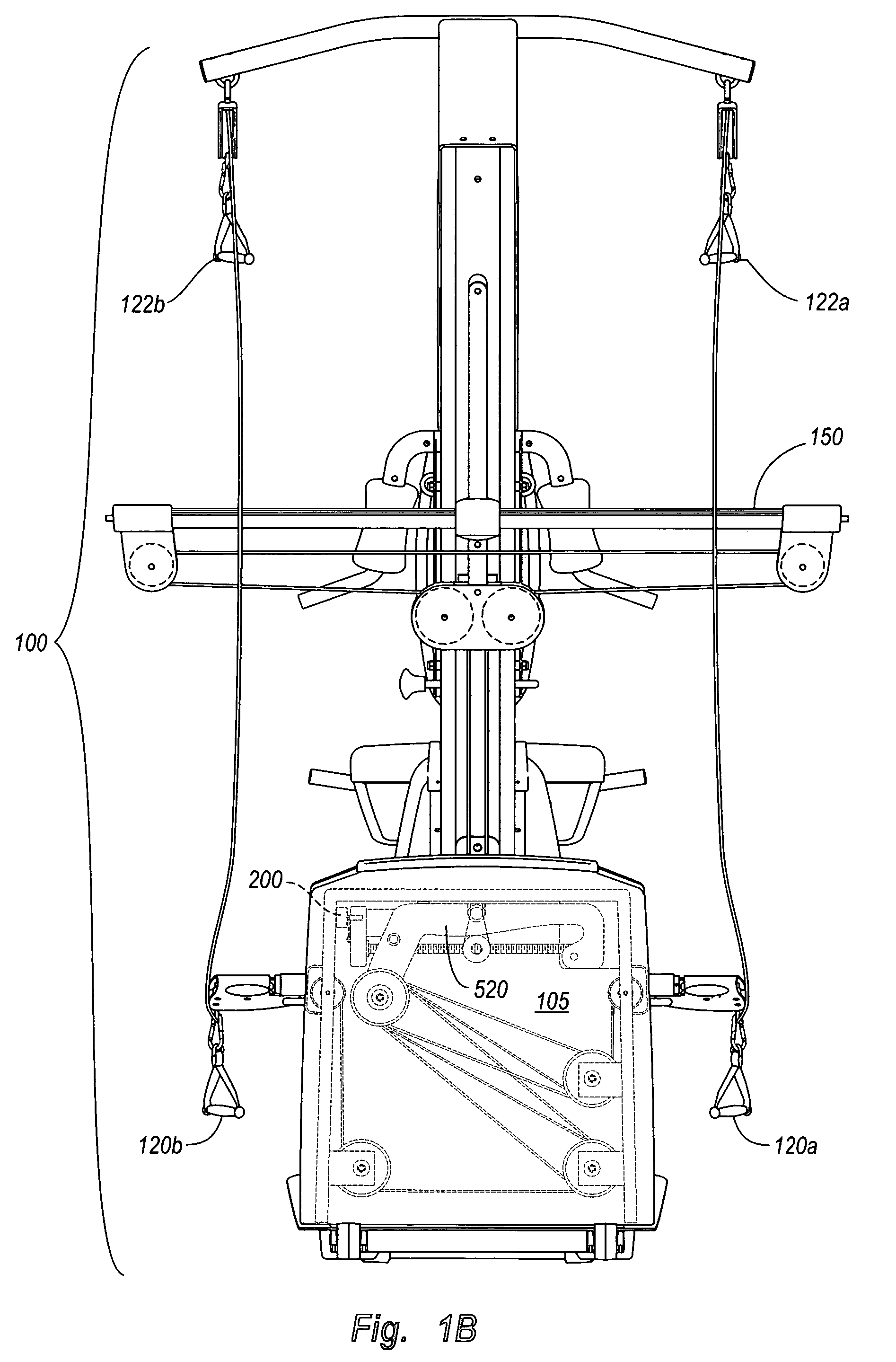

Repetition sensor in exercise equipment

ActiveUS7628737B2Accurately monitor shortDetection speedClubsResilient force resistorsSports equipmentEngineering

An exercise repetition sensor comprises an electricity generator, such as an electricity generator, which is coupled to an exercise system, where the electricity generator is capable of sensing exercise movements of any size or intensity on the exercise system. The electricity generator can be based on a number of electrical, magnetic, or optical sensing principles. For example, an electricity generator comprising an electricity generator includes a spindle that is coupled to one or more parts that move in proportion to an applied force. The voltage-generator generates an electrical current as the spindle moves, and sends the electrical current to an electronic display interface. In one embodiment, the voltage-generator sends a positive direct current through one of two circuit wires to the electronic console, such that the electronic console can immediately identify that the user has performed an exercise repetition.

Owner:IFIT INC

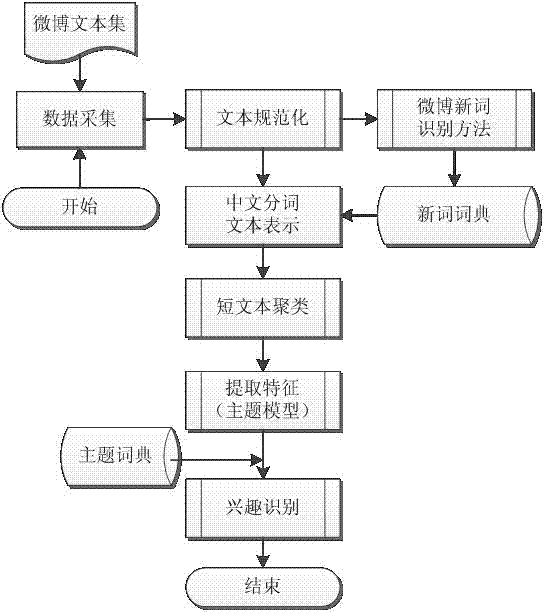

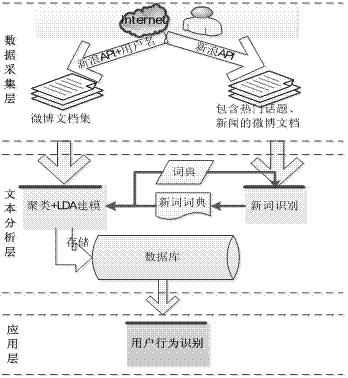

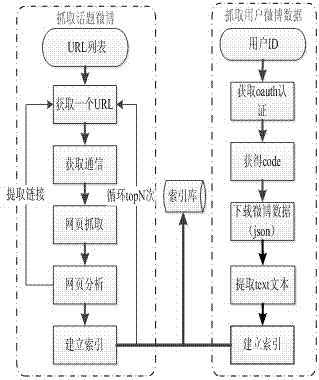

Microblog user interest recognizing method based on text mining

InactiveCN103942340AImprove recognition accuracyReduce raw data volumeSpecial data processing applicationsText database clustering/classificationText miningFeature extraction

The invention discloses a microblog user interest recognizing method based on text mining, and belongs to the field of text mining and natural language processing. The method includes the steps of collecting the newest topical microblog text data of a microblog text set and microblog text data of a designated user, standardizing the collected microblog text data, recognizing the newest microblog words and renewing a new word dictionary for the standardized topical microblog text data through the microblog new word recognition method, conducting Chinese character word separation on the standardized microblog text data of the designated user through the new word dictionary word separation method to achieve text vector expression, clustering the microblog text data, expressed through text vectors, of the designated user, recombining original microblog text data, extracting new text set features through a topic model, presetting topic dictionaries, calculating the weight of each topic dictionary based on the new text set features to obtain the final topic, and enabling the final topic to serve as the microblog user interest recognition, thereby improving accuracy of feature extraction.

Owner:UNIV OF ELECTRONICS SCI & TECH OF CHINA

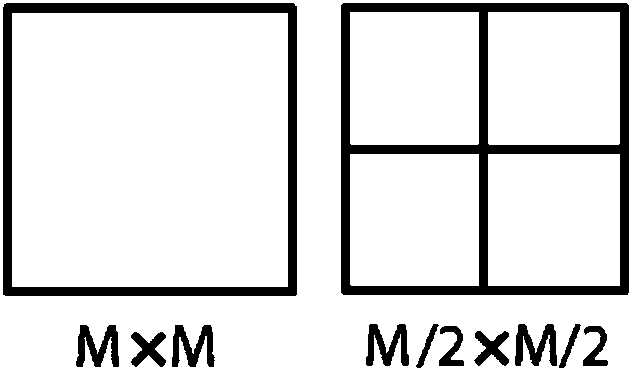

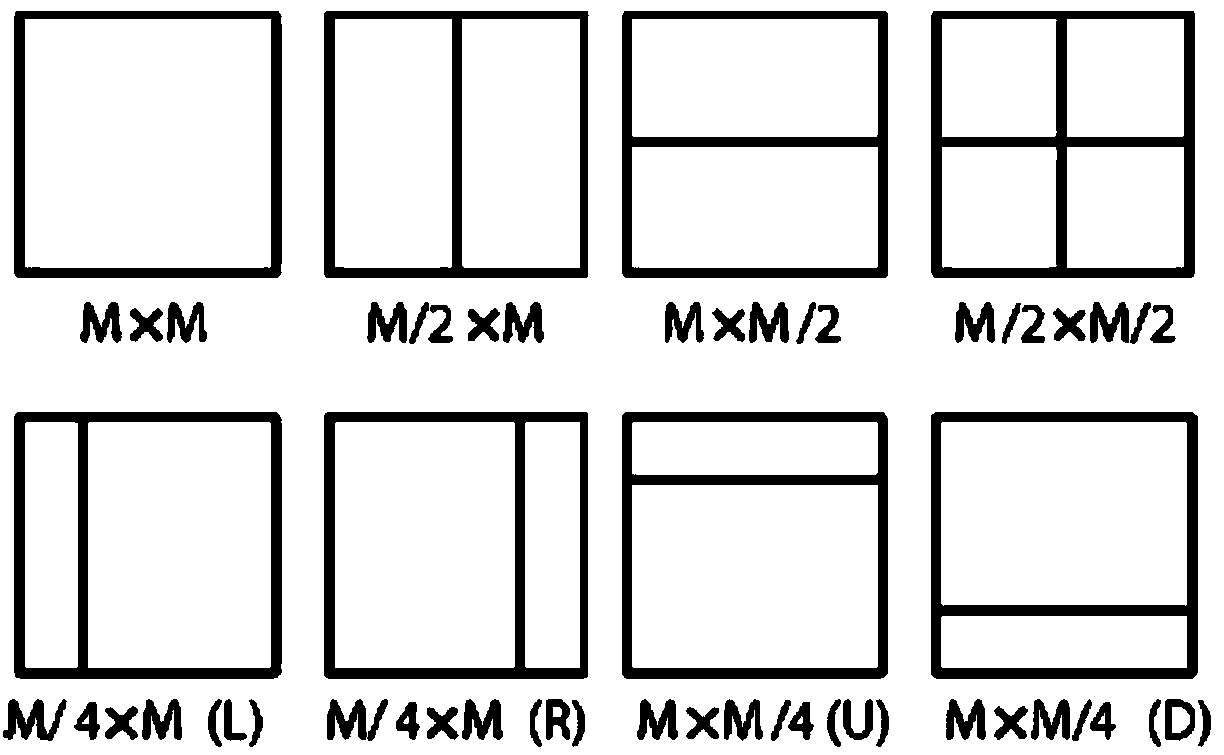

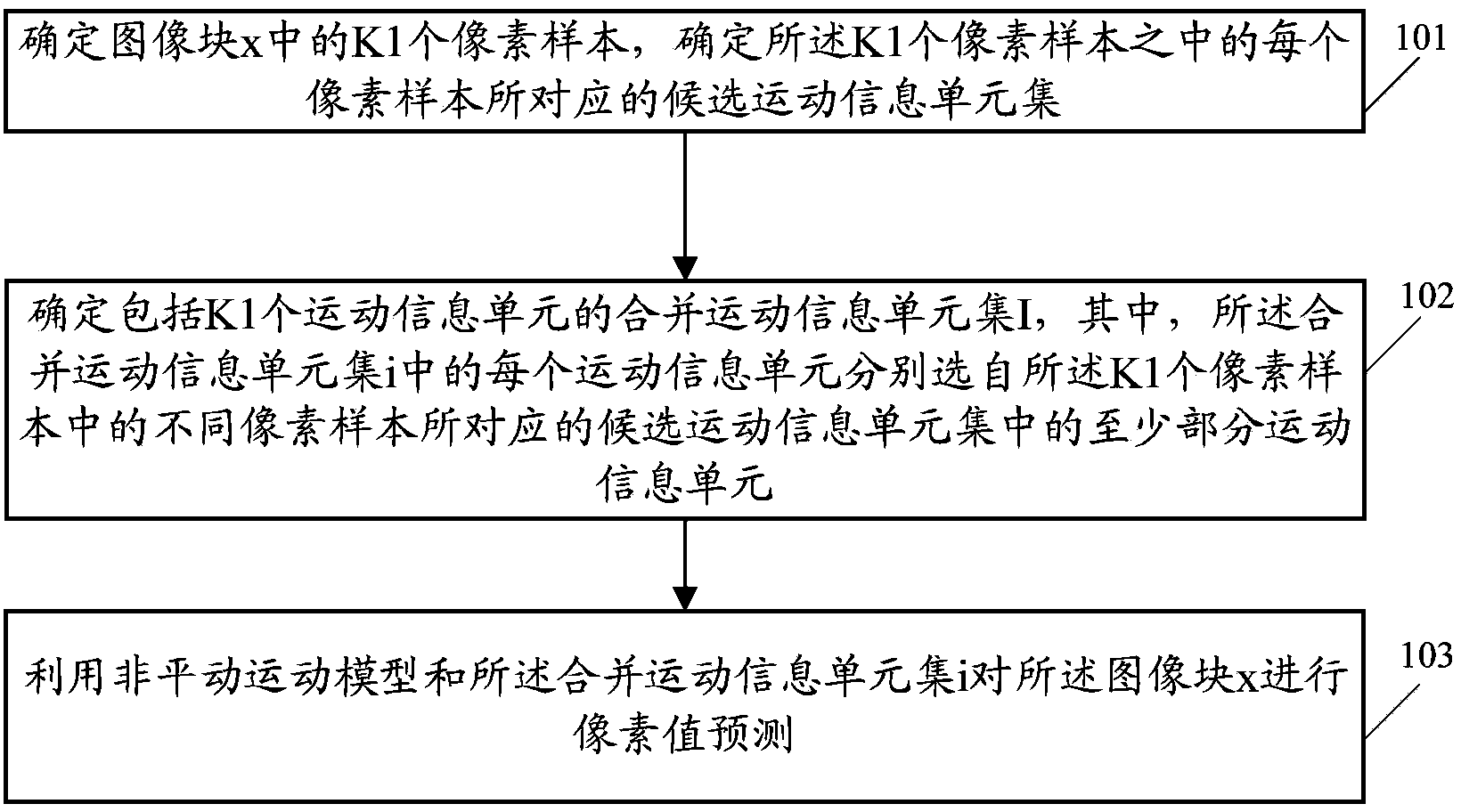

Image forecasting method and related device

ActiveCN104363451AAccurate descriptionImprove coding efficiencyDigital video signal modificationPattern recognitionComputation complexity

The invention discloses an image forecasting method and a related device. The image forecasting method includes: confirming K1 pixel samples in an image block x, and confirming a candidate movement information unit set corresponding to each of the K1 pixel samples; enabling each candidate movement information unit set corresponding to each pixel sample to include at least one candidate movement information unit; confirming a merger movement information unit set i which includes K1 movement information units; using a non-translation movement model and the merger movement information unit set i to forecast pixel values of the image block x, wherein all the movement information units in the merger movement information unit set i are respectively selected from at least a part of the movement information units in the candidate movement information unit sets corresponding to the different pixel samples in the K1 pixel samples. The image forecasting method and the related device facilitate reduction of computation complexity of image forecasting based on the non-translation movement model.

Owner:HUAWEI TECH CO LTD

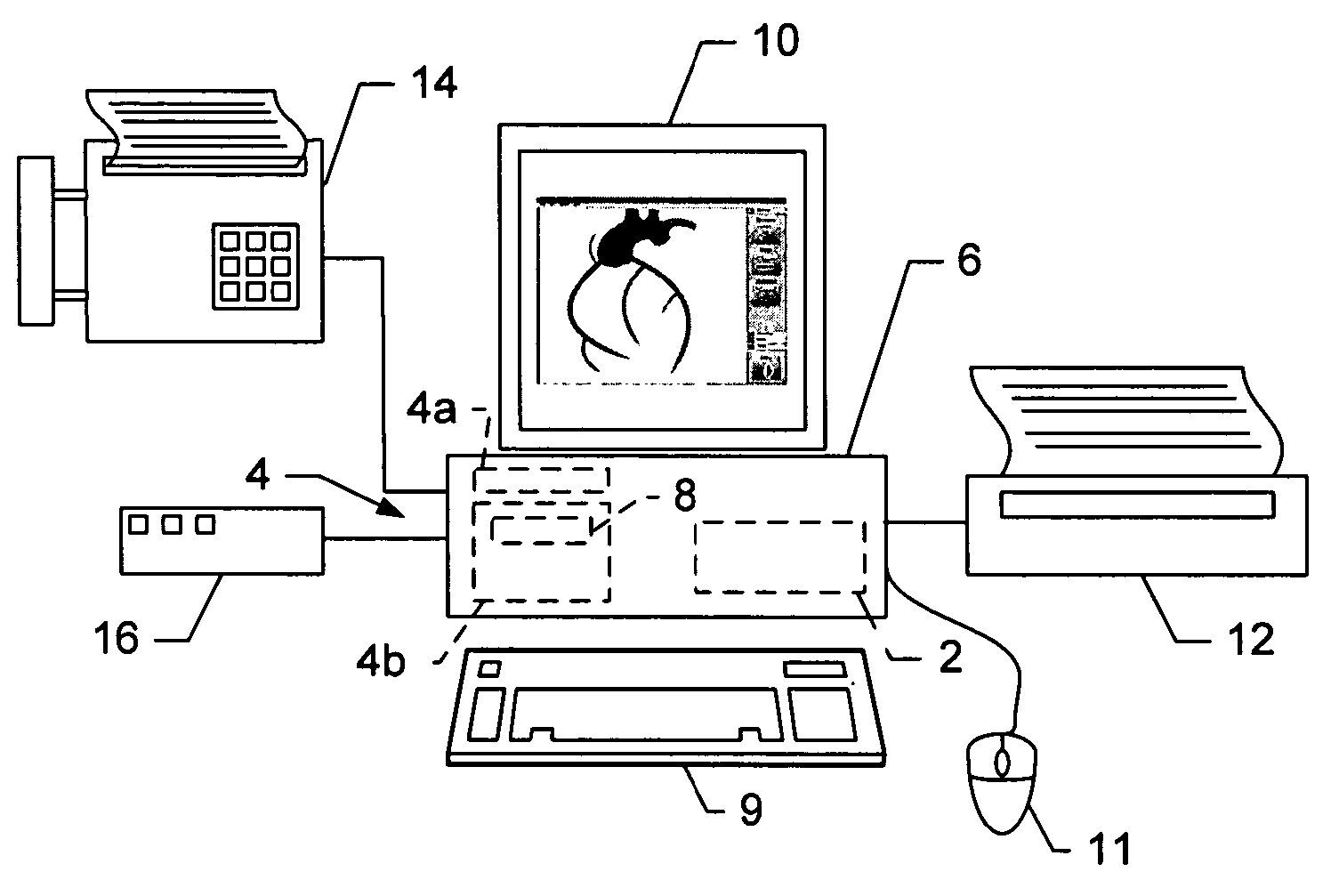

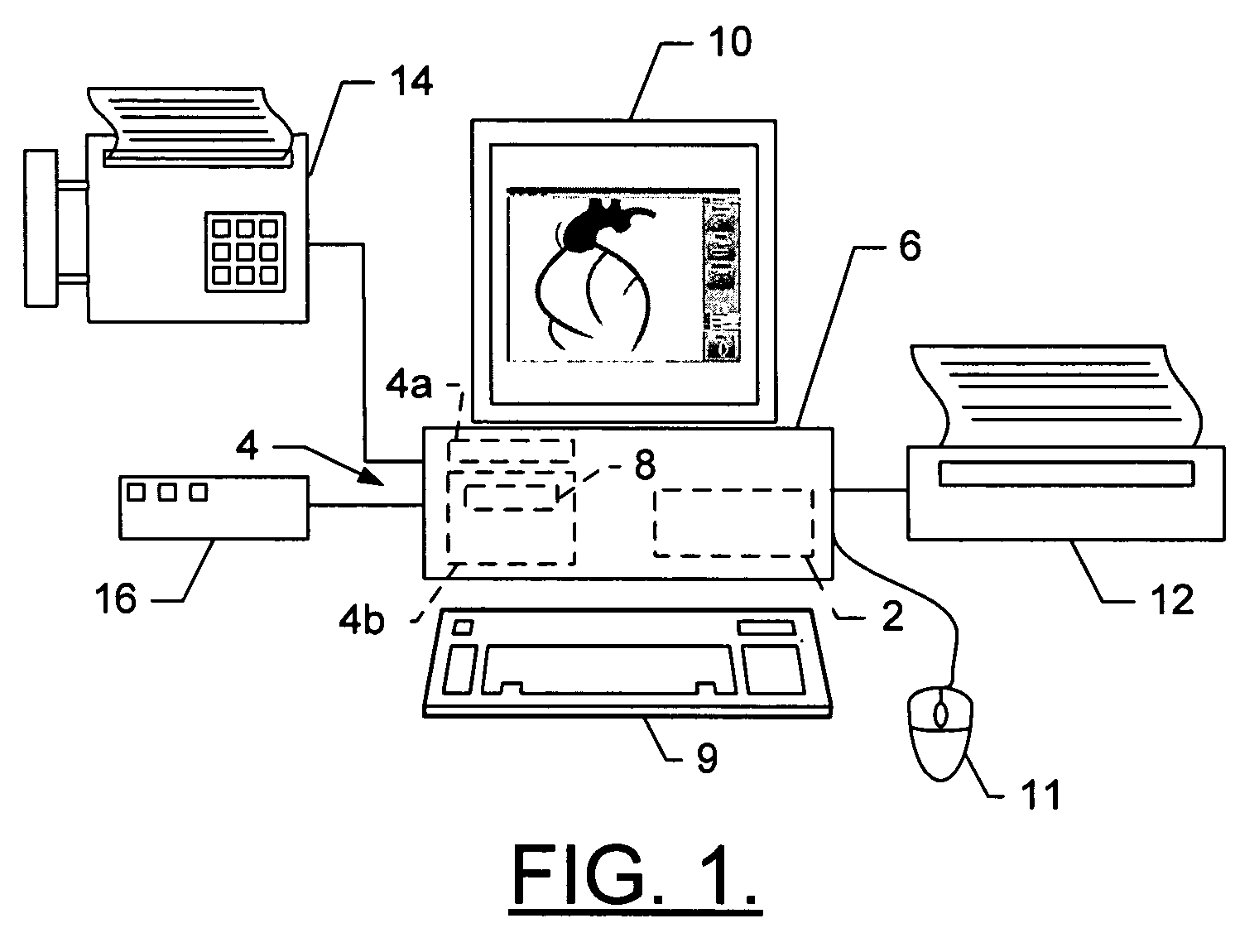

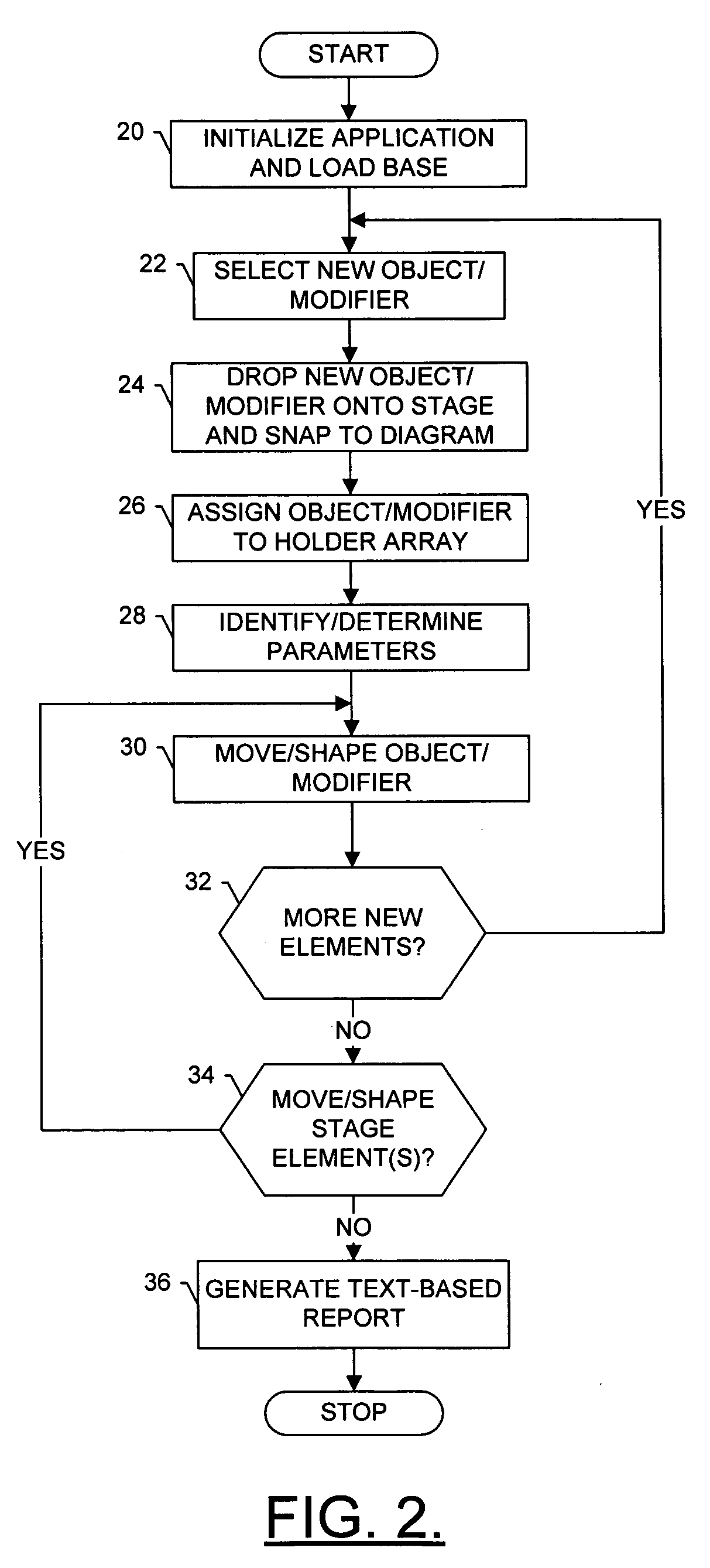

System, method and computer program product for graphically illustrating entities and generating a text-based report therefrom

ActiveUS20060262134A1Increase grammatical accuracyAccurately illustrateData processing applicationsLocal control/monitoringGraphicsUser input

A computer-implemented method for graphically illustrating an entity and generating a text-based report therefrom includes providing a visual base representation of an entity. The base representation includes a plurality of elements at least one of which is modifiable, where the elements are each associated with a plurality of attributes. A visual diagram of a particular entity is built based upon the base representation of the entity. In this regard, at least one visual element is added to the base representation, where the added visual elements are modifiable. Accordingly, the diagram includes the elements of the base representation and the elements added to the base representation. After determining attributes associated with the added elements, a text-based report is generated from the diagram, where the report is generated based upon the elements of the diagram and the associated attributes, and where the report is automatically generated from the diagram without user input.

Owner:IONOSOFT

Systems and methods for obtaining biometric information at a point of sale

InactiveUS20050125296A1Accurate descriptionSlow processPaper-money testing devicesPoint-of-sale network systemsBiometric dataCheque

Systems and methods are described for using a point-of-sale device to obtain biometric information from an individual presenting a second-party check in association with a proposed check-cashing transaction. In various embodiments, a biometric sample is obtained from the check presenter and is compared to stored biometric data in order to enhance an assessment of the correct identification of the check presenter. In various embodiments, the biometric information, along with other transaction-related information, such as information about one or more authentication marks from the check, is transmitted to a check authorization system for a risk assessment of the transaction. In various embodiments, the point-of-sale device may receive an accept / decline recommendation from the check authorization system, based at least in part on the biometric information and may display a message about the recommendation to an operator of the point-of-sale device.

Owner:THE WESTERN UNION CO +1

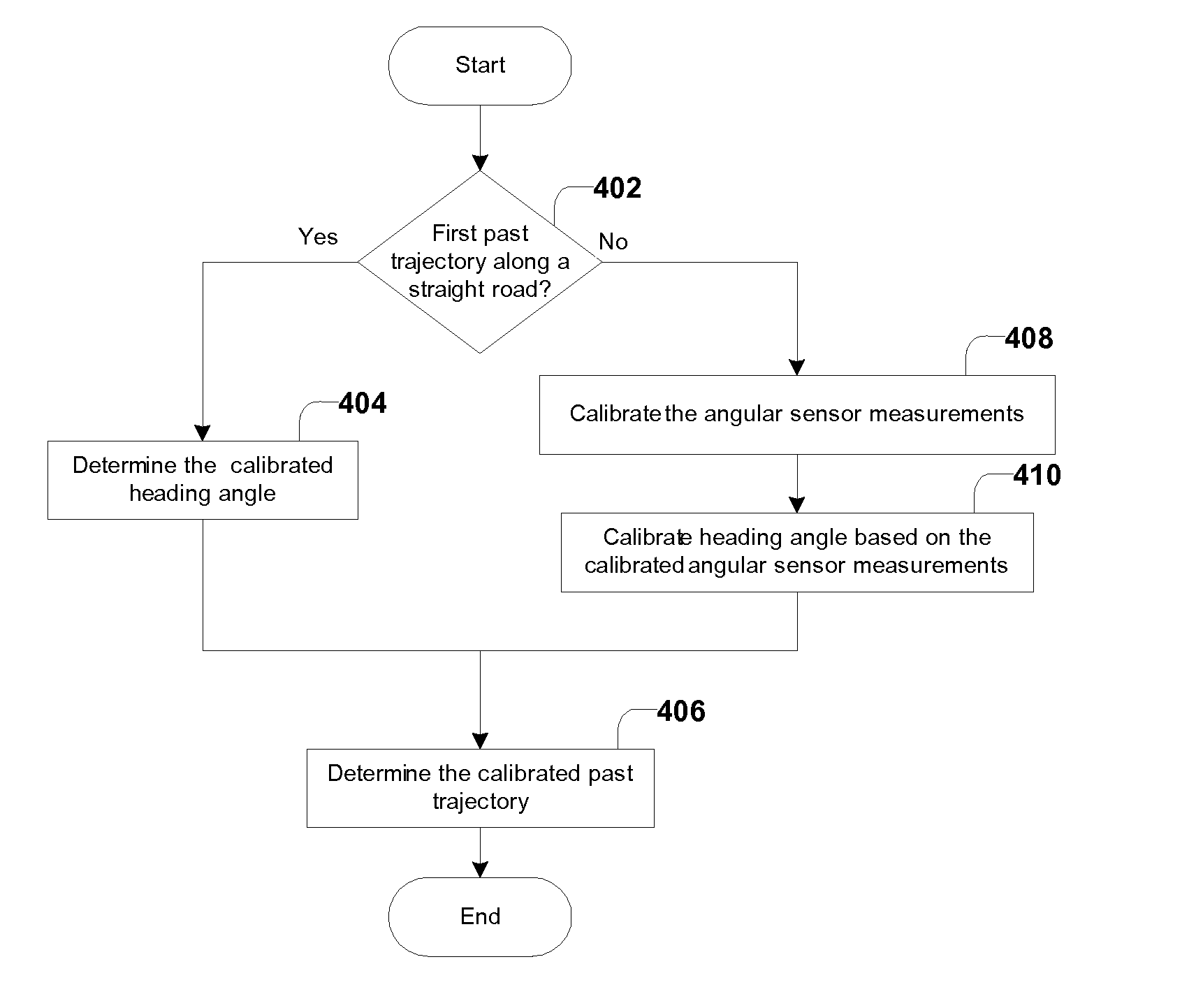

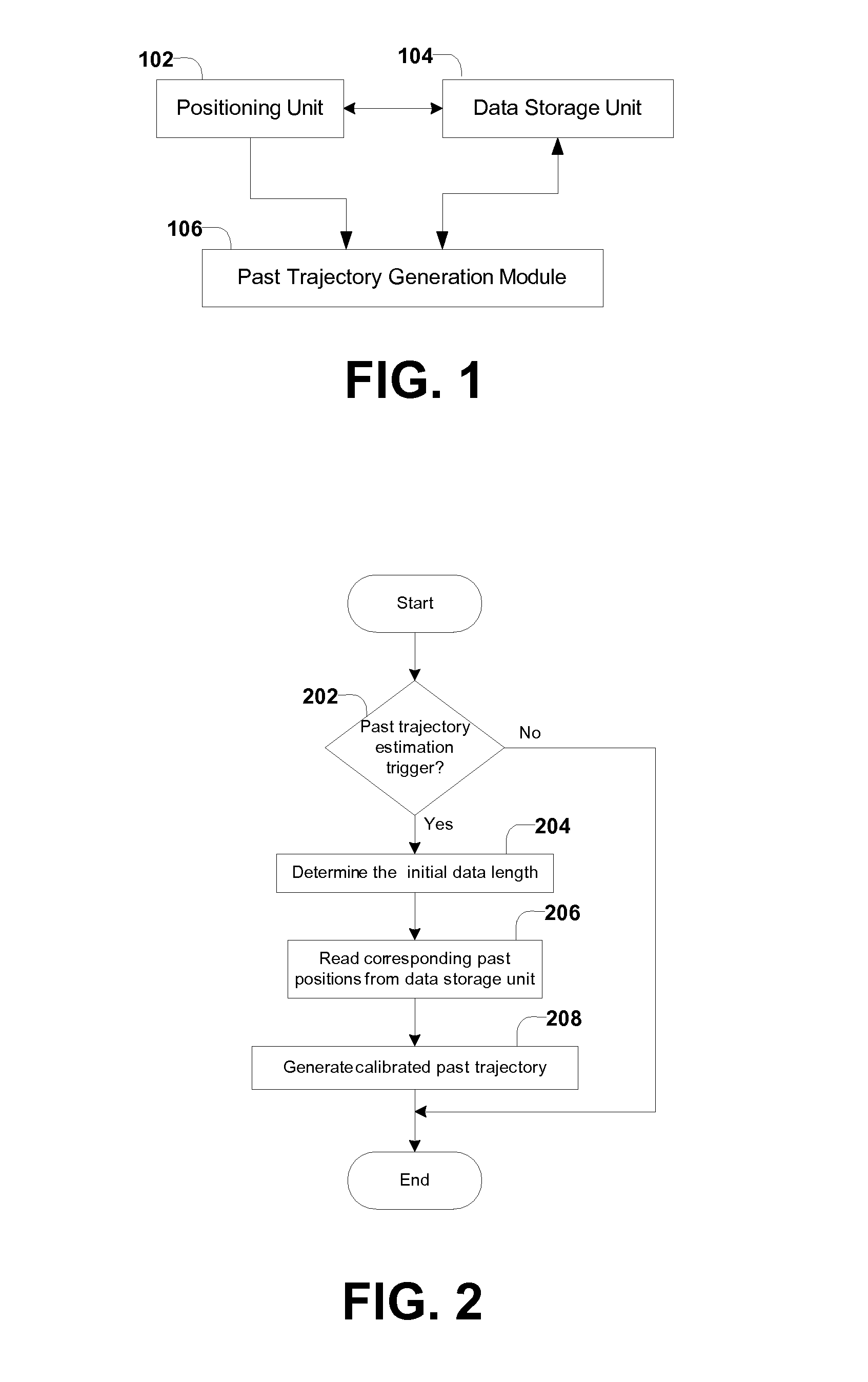

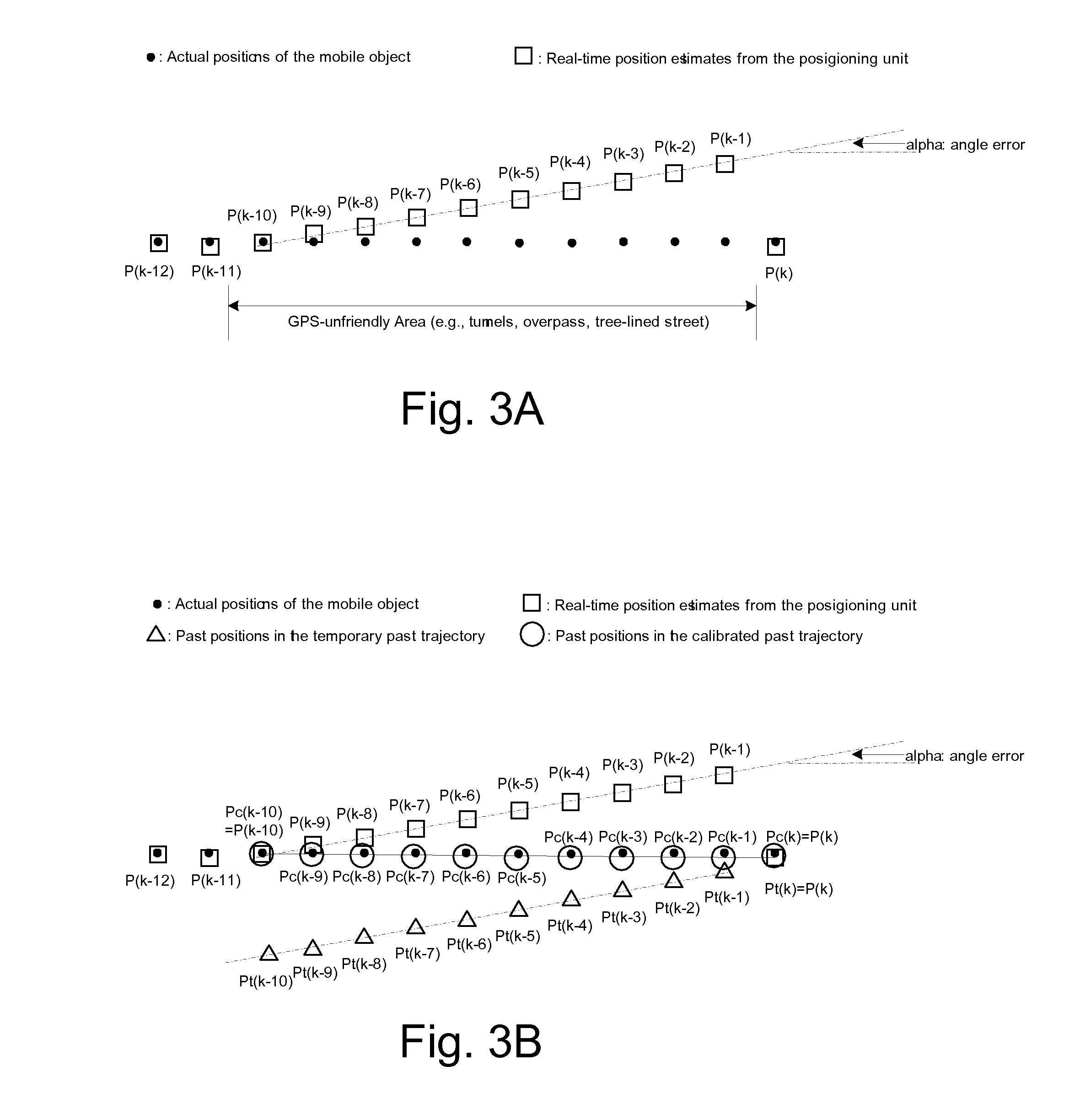

Automatic correction of past position errors for location and inventory tracking

ActiveUS20100332125A1Few or no effectsAccurate descriptionPosition fixationNavigation instrumentsPosition errorComputer science

A method is provided for calibrating past position estimates from a positioning system that provides real-time position estimates of a mobile object. The method first stores the real-time position estimates, which as time goes by become past position estimates and naturally form a first past trajectory depicting the past movement of the mobile object. Subsequently, a calibrated past trajectory is determined, which includes calibrated past position estimates that correspond to the same time instances as the past positions in the first past trajectory. When real-time positions have low qualities, this method calibrates them at a later time by using (higher-quality) real-time positions both before and after them. Errors in the past positions are then corrected based on the calibrated past trajectory. When used with event detectors that indicate inventory transactions, this method can correct position errors associated with inventory events so as to improve the performance of inventory tracking.

Owner:MI JACK PRODS

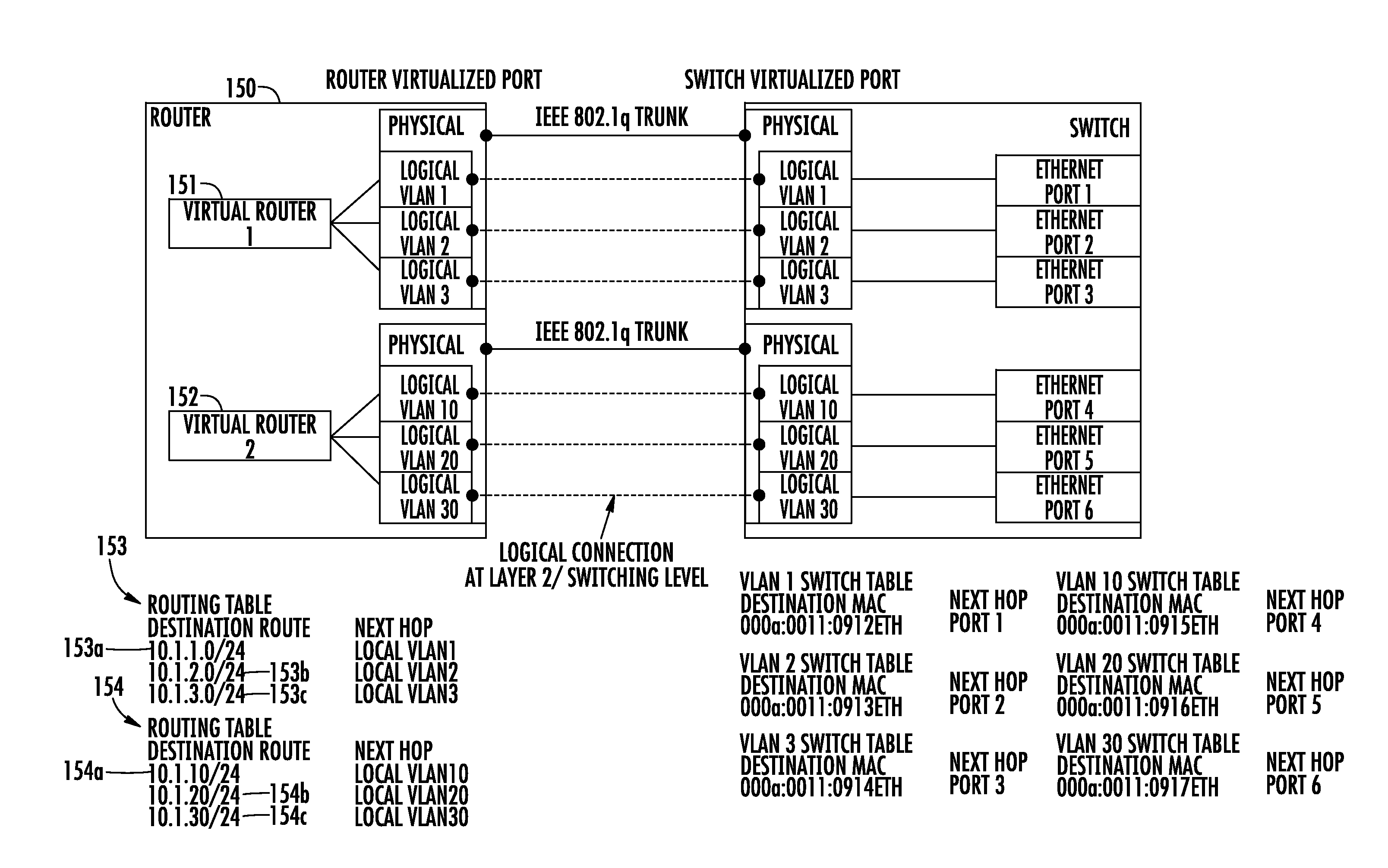

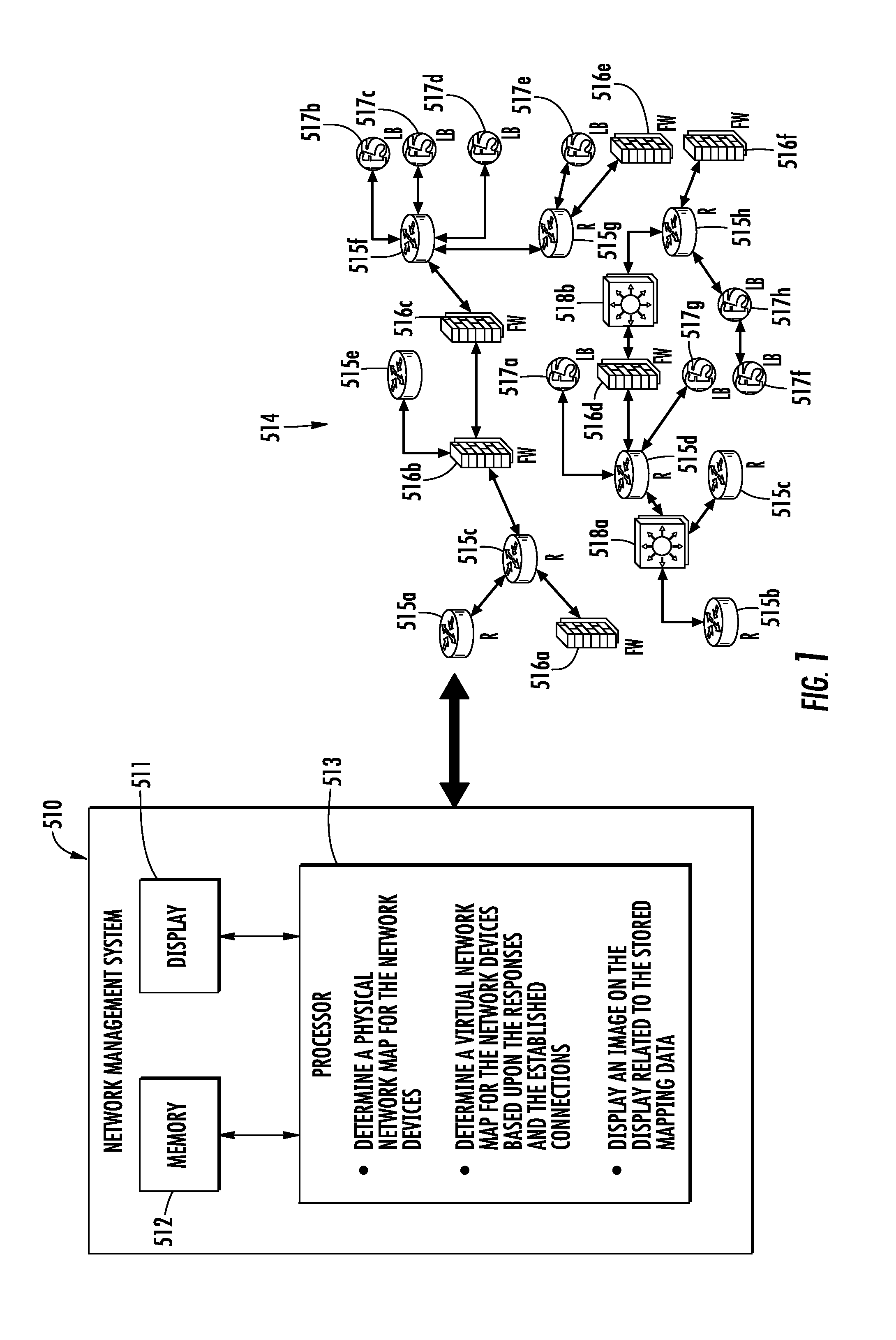

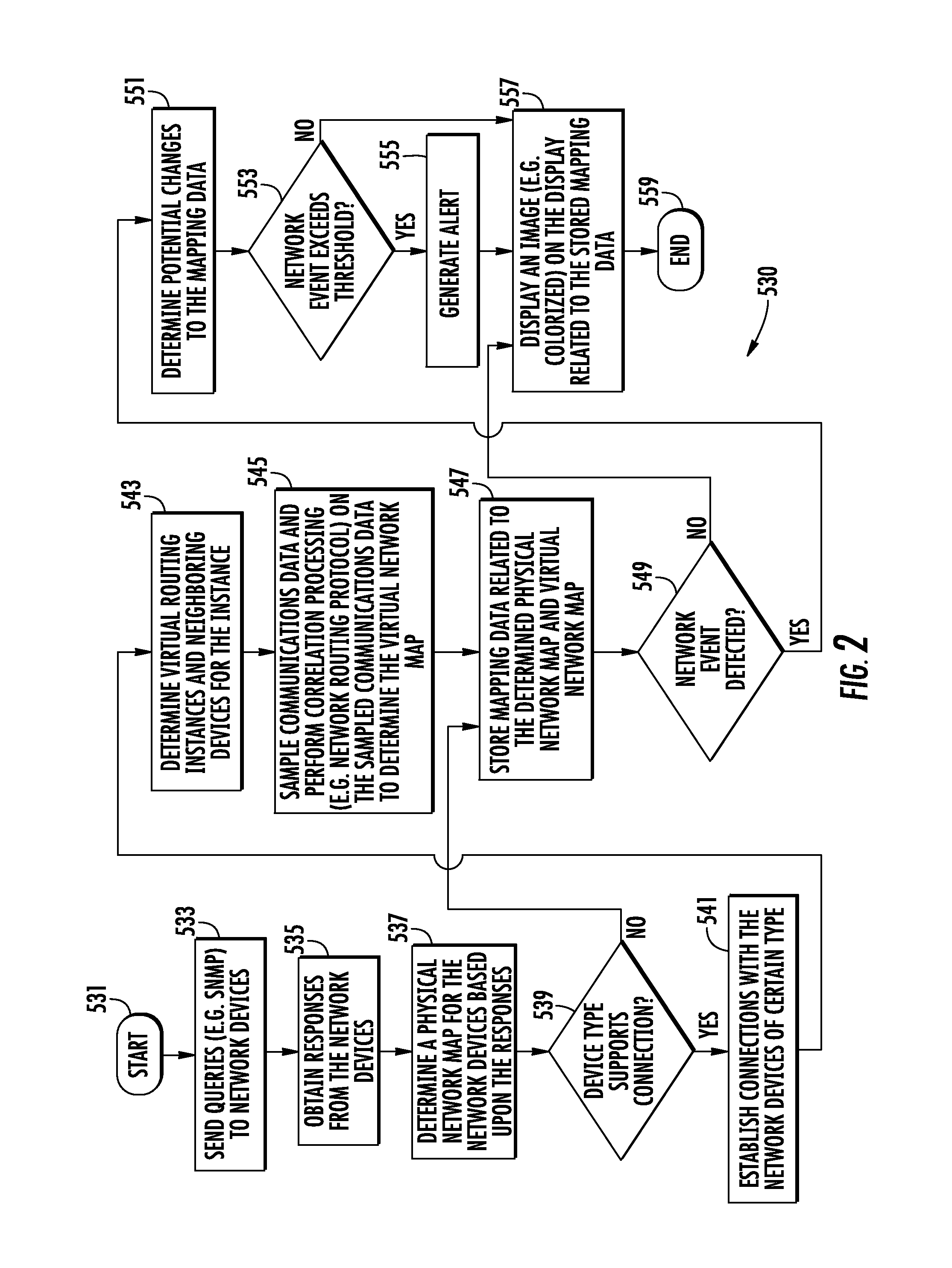

Network management system generating virtual network map and related methods

ActiveUS20150043378A1Accurate descriptionAccurate dataData switching by path configurationDisplay deviceNetwork management

A network management system is for a network having network devices. The network management system includes a display, a memory, and a processor coupled to the display and memory and configured to send queries to the network devices, obtain responses from the network devices based upon the queries, and determine a physical network map for the network devices based upon the responses. The processor is also configured to establish connections with some of the network devices, determine a virtual network map for the network devices based upon the responses and the established connections, store mapping data related to the determined physical network map and virtual network map in the memory, and display an image on the display related to the stored mapping data.

Owner:HARRIS CORP

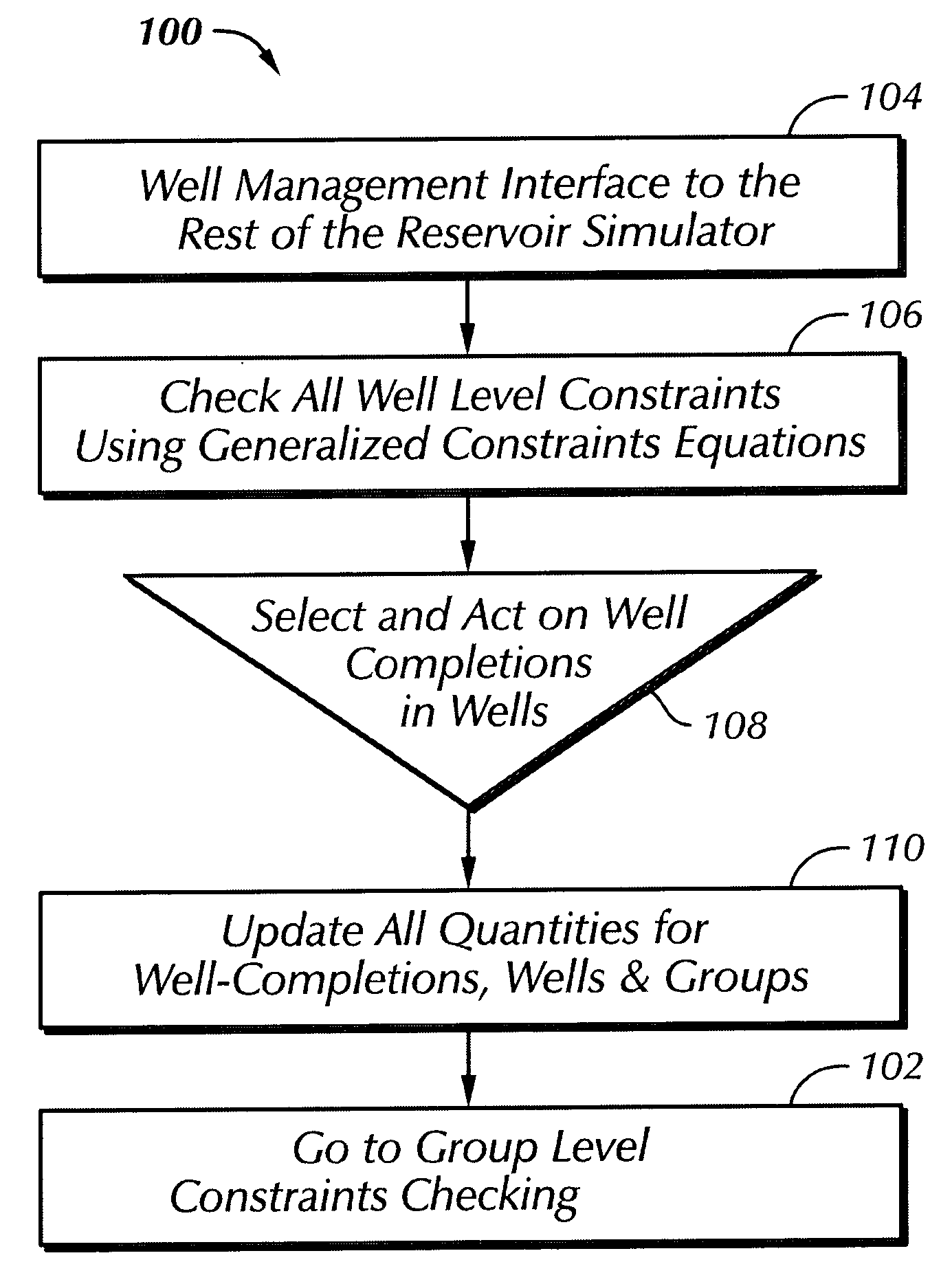

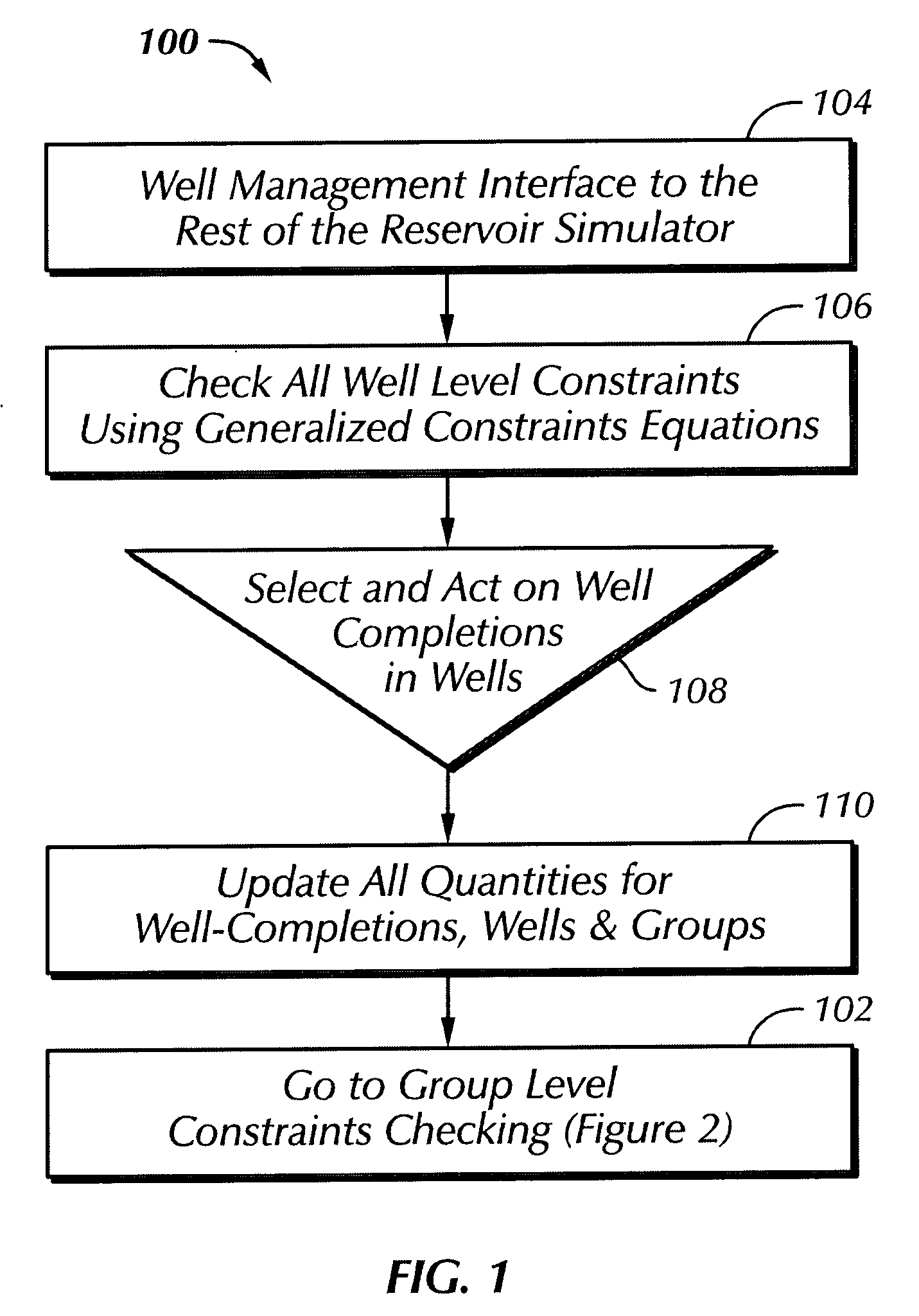

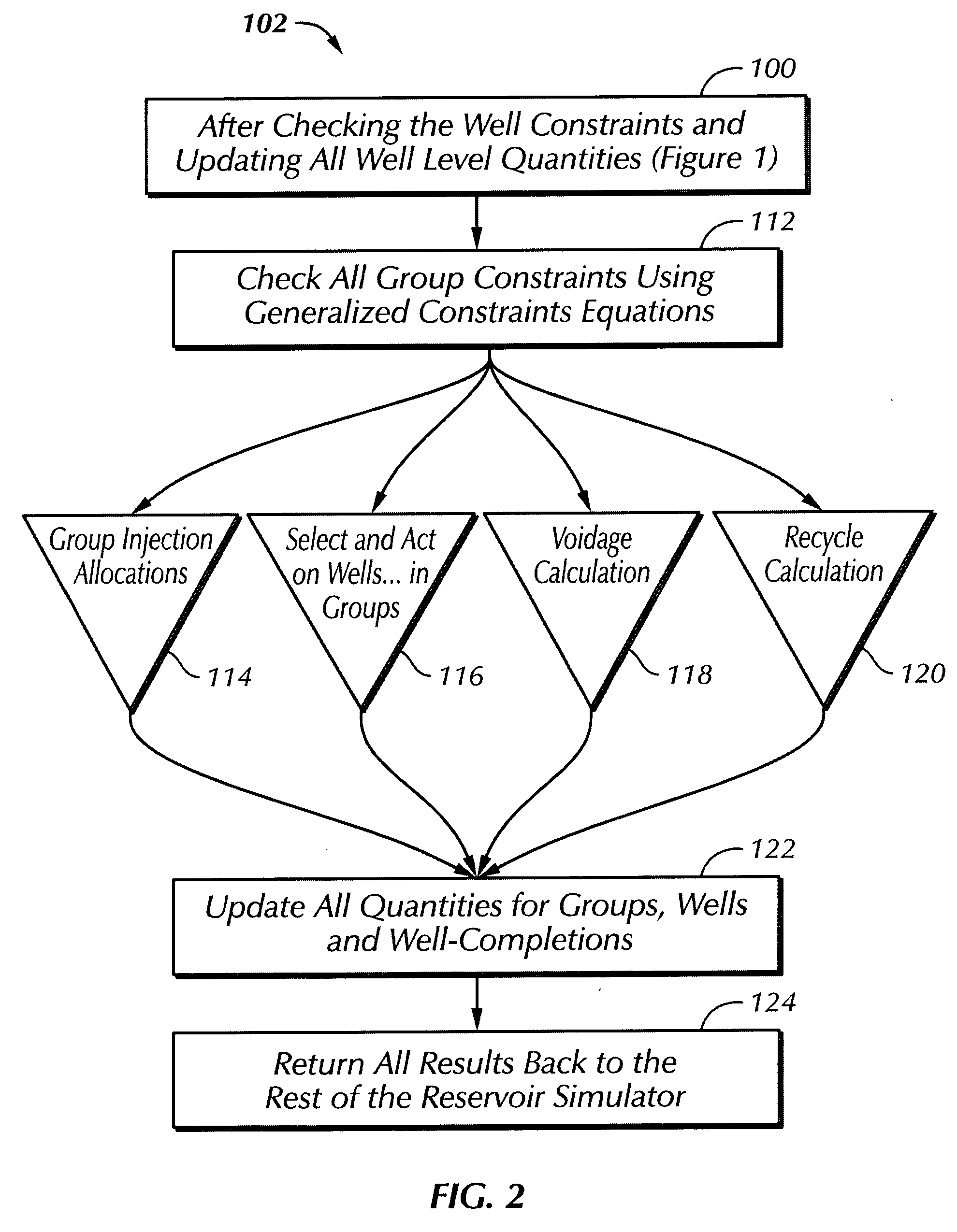

Generalized well management in parallel reservoir simulation

ActiveUS20060085174A1Easy to useRequire extensiveForecastingAdaptive controlHydrogen compoundsProcess engineering

A computer-implemented process simulates production of oil and gas from hydrocarbon reservoirs. The process is used to help forecast the optimal future oil and gas recovery from large hydrocarbon reservoirs. At the same, this process is flexible to allow for further addition of new options; robust and reliable; and easy to use. The process is also comprehensive in that it allows a forecast of future performance of a wide range of reservoirs and future operation scenarios. By using the high-resolution models provided, a reservoir can be described much more accurately.

Owner:SAUDI ARABIAN OIL CO

Systems and methods for assessing the risk of a financial transaction using authenticating marks

Systems and methods are described for better assessing risk associated with cashing second-party checks and other negotiable instruments. The systems and methods make use of information about authenticating marks, such as watermarks, bar codes, insignia, background patterns, and the like, from a check in order to better assess the legitimacy and cashability of the check. In various embodiments, information about an authenticating mark may be compared to stored information about an expected configuration for the authenticating mark. In various embodiments, a gradated risk score may be generated, based at least in part on the comparison. In various embodiments, the risk score may be combined with risk scores that are descriptive of other aspects of a check cashing transaction to calculate a risk score for the transaction as a whole. In some embodiments, the transaction risk score may be used to generate an accept / decline recommendation for the transaction.

Owner:FIRST DATA

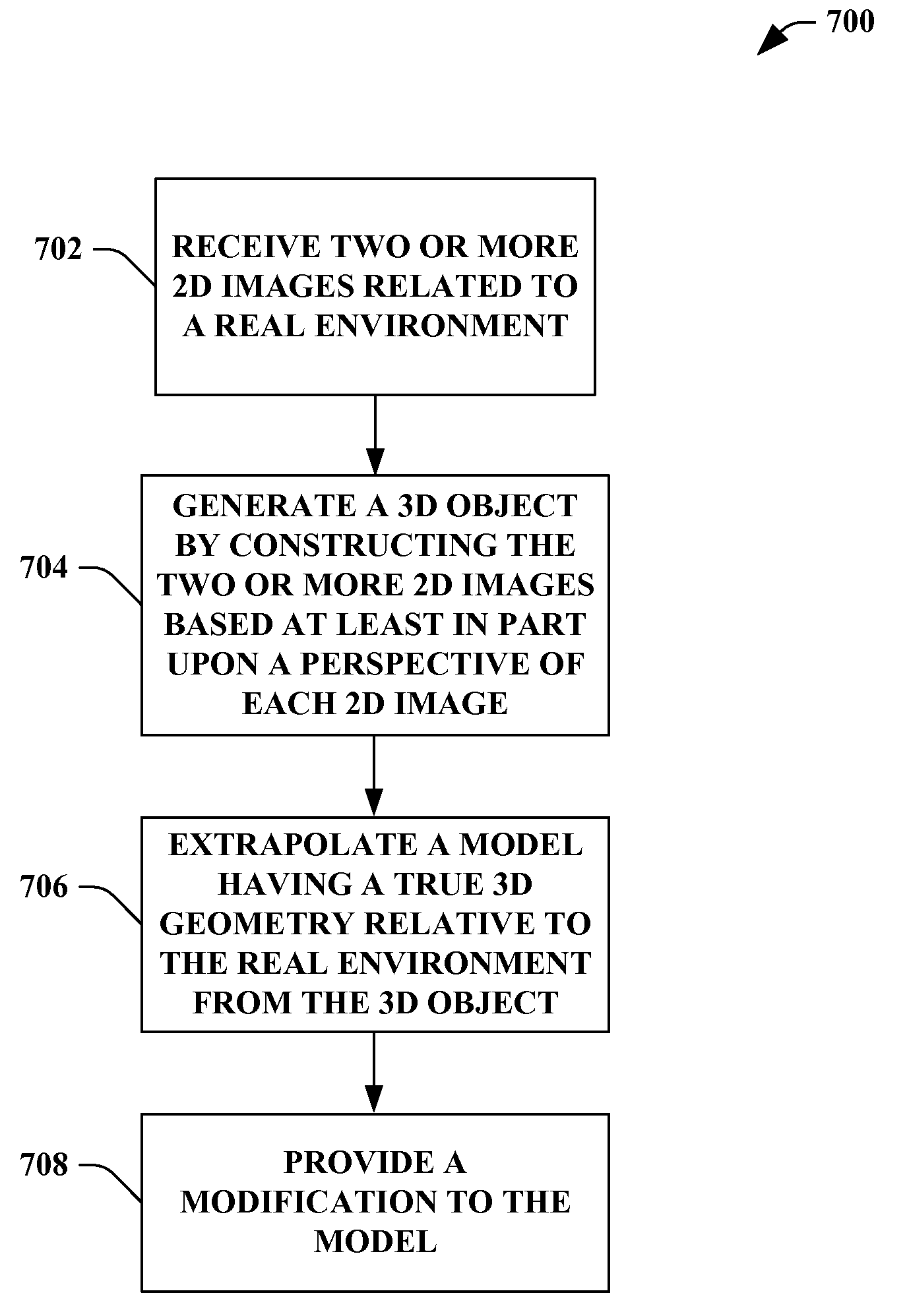

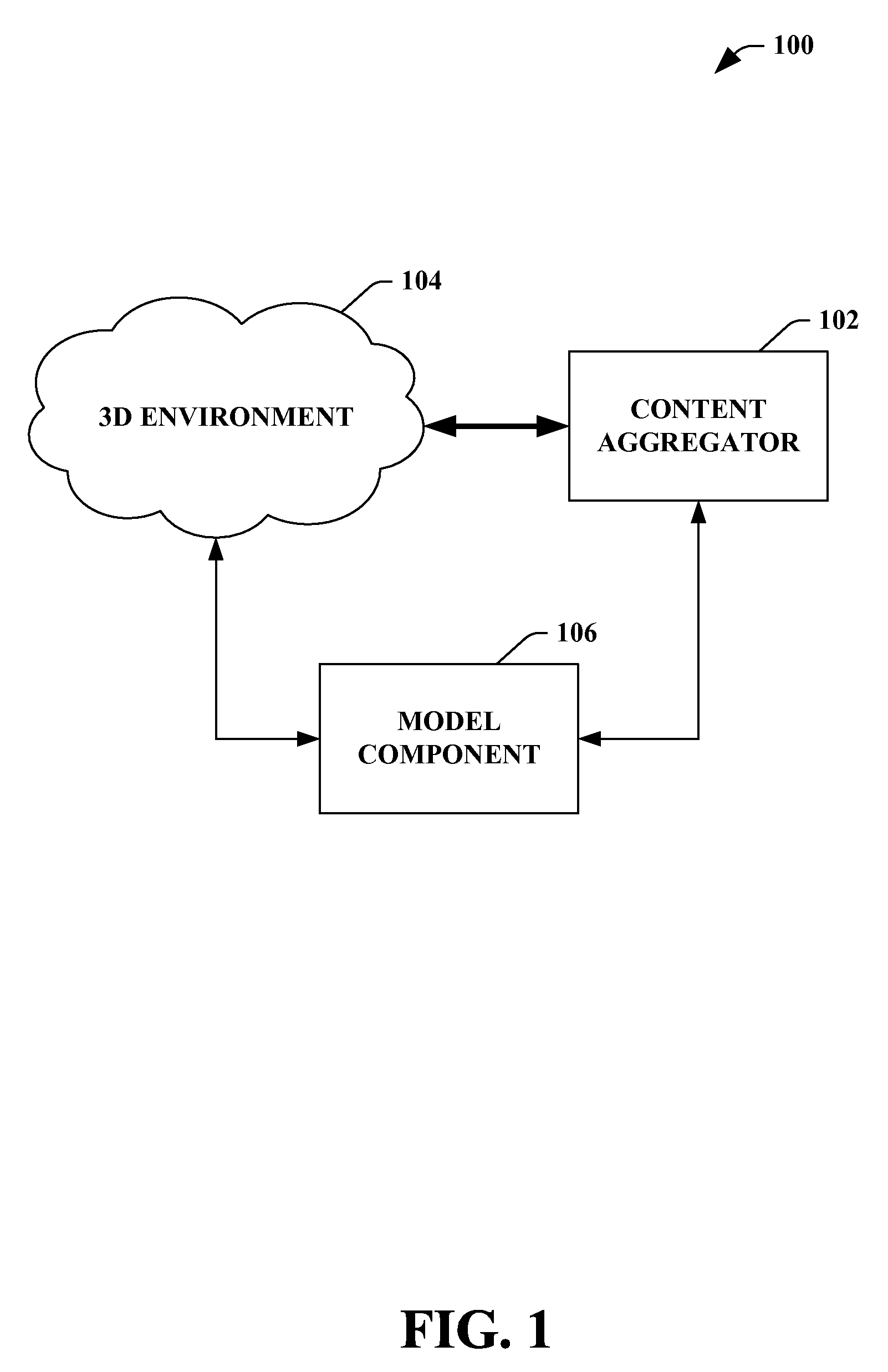

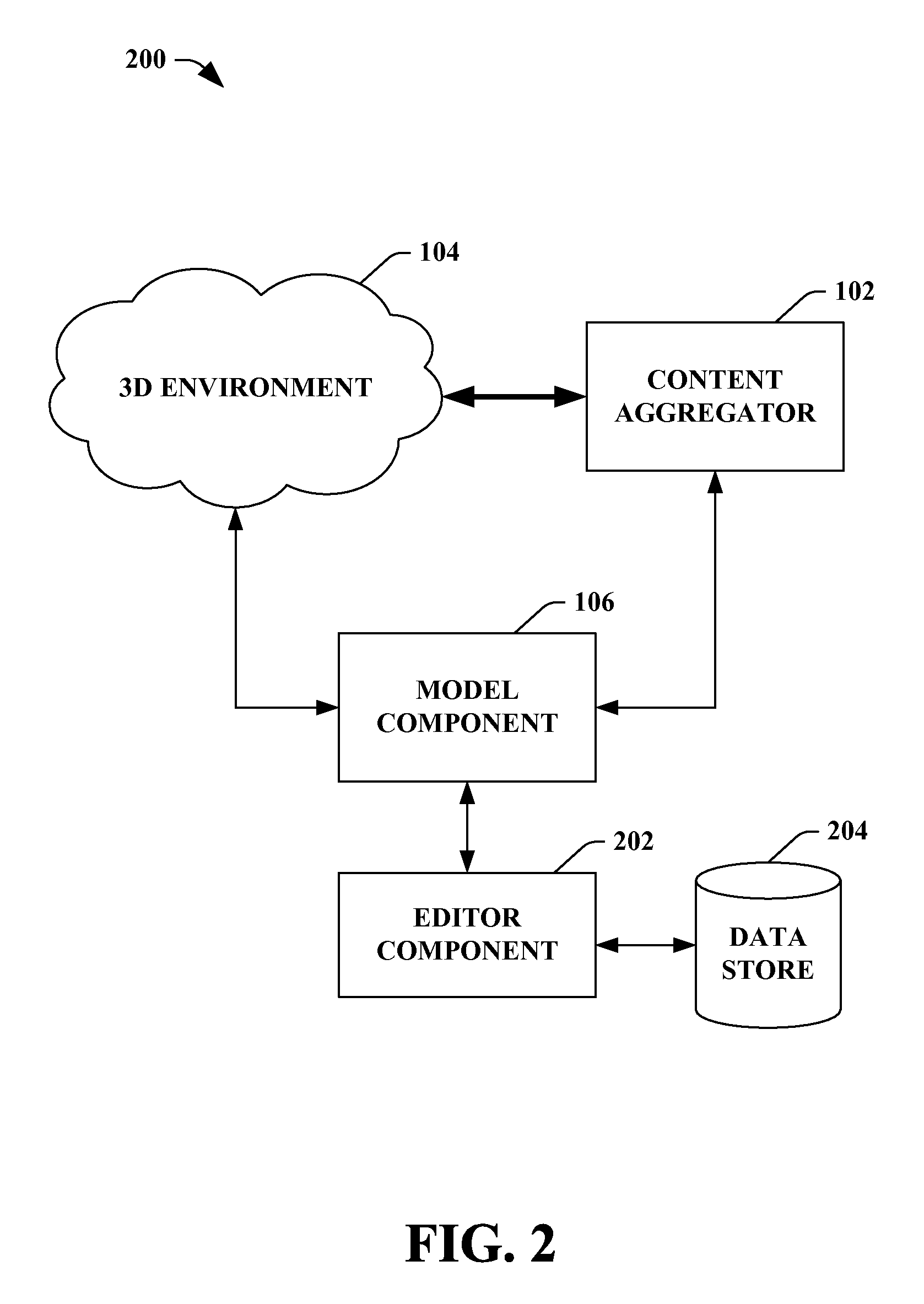

Procedural authoring

ActiveUS20090279784A1Accurate descriptionAccurate representationImage enhancementImage analysis2d imagesGenerative model

The claimed subject matter provides a system and / or a method that facilitates generating a model from a 3-dimensional (3D) object assembled from 2-dimensional (2D) content. A content aggregator can construct a 3D object from a collection of two or more 2D images each depicting a real entity in a physical real world, wherein the 3D object is constructed by combining the two or more 2D images based upon a respective image perspective. A 3D virtual environment can allow exploration of the 3D object. A model component can extrapolate a true 3D geometric model from the 3D object, wherein the true 3D geometric model is generated to include scaling in proportion to a size within the physical real world.

Owner:MICROSOFT TECH LICENSING LLC

Systems and methods for assessing the risk of a financial transaction using biometric information

ActiveUS7398925B2Accurate descriptionAccurate transactionFinancePayment architectureConfidence metricCheque

Owner:FIRST DATA

System for providing emergency medical care with real-time instructions and associated methods

InactiveUS20060111749A1Optimize (i.eFunction is performedRespiratorsElectrocardiographyGraphicsBasic life support

A basic life support system (BLSS) includes a processing element and an output element, such as a display screen or an audio output element, for providing an individual with real-time instructions on providing emergency medical care to a patient until paramedics or other healthcare professionals arrive to take over care for the patient. The instructions may be provided as graphics, including animations, as text, audibly, or as a combination of visible and audible elements. The BLSS may be configured for providing emergency medical care to individuals who have suffered from ventricular fibrillation. Accordingly, the BLSS may also include a defibrillation apparatus, an air or oxygen supply, a respiratory interface, one or more sensors, or a combination thereof.

Owner:UNIV OF UTAH RES FOUND +1

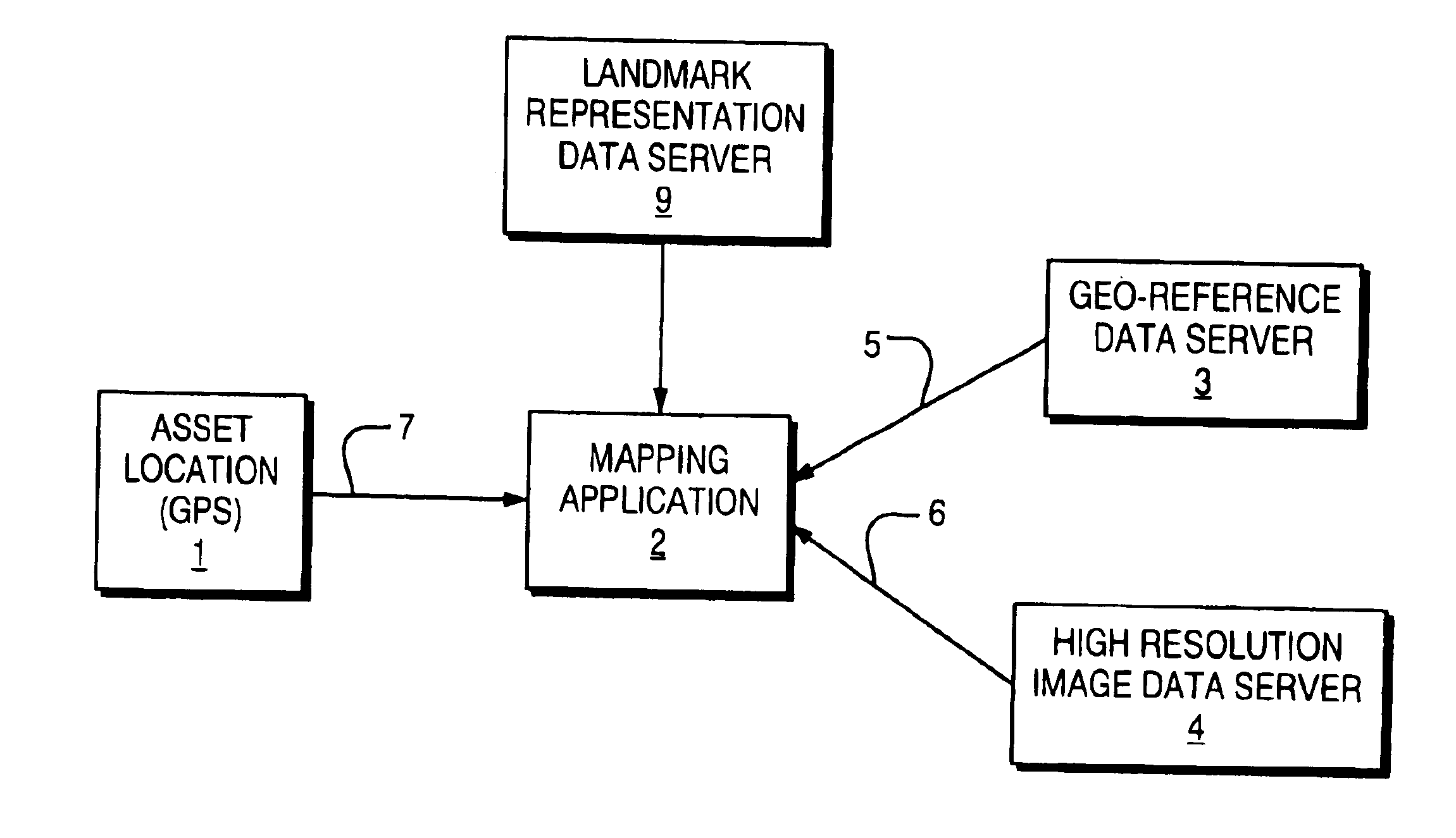

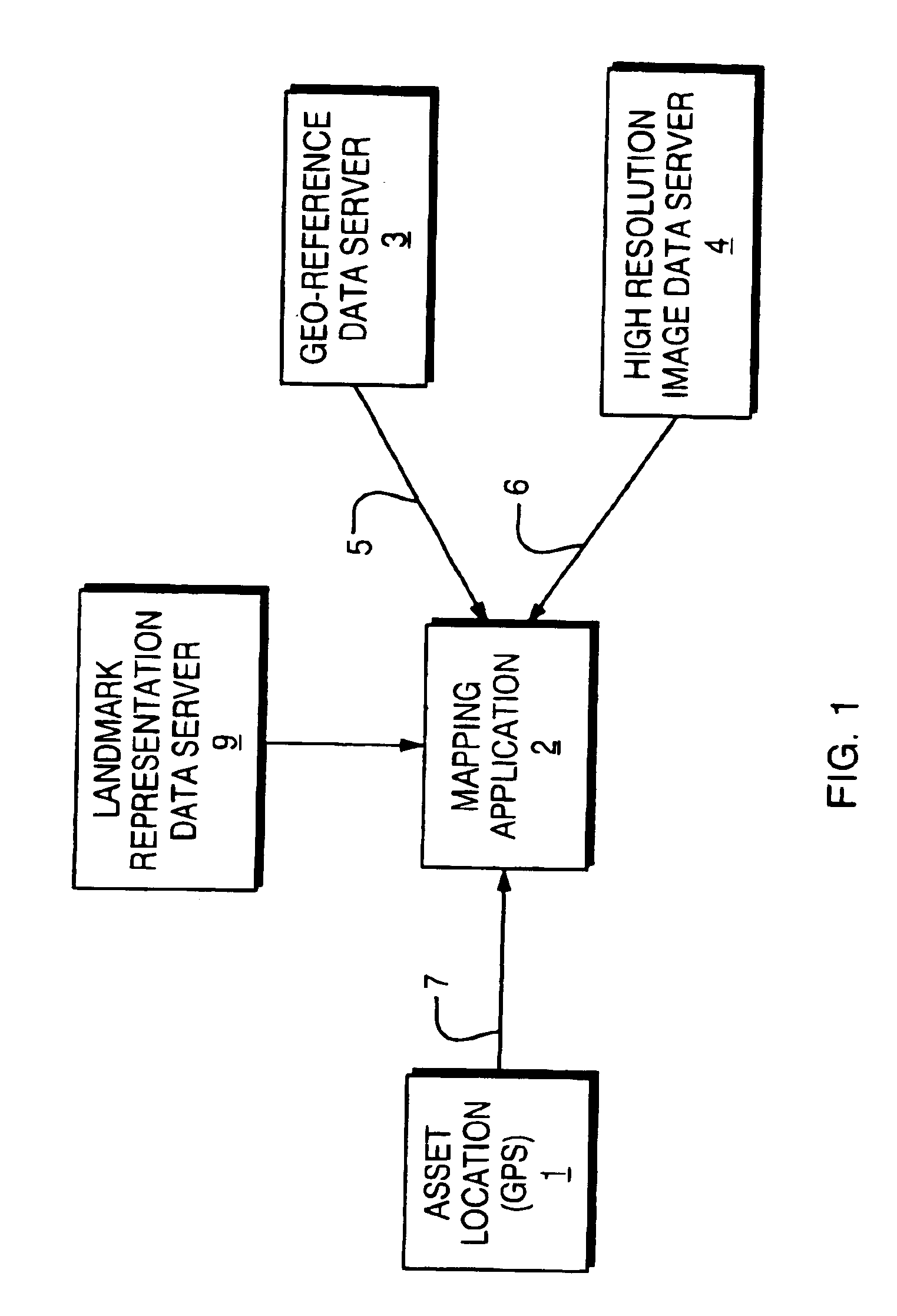

High resolution tracking of mobile assets

InactiveUS6920391B2Accurate descriptionAccurate displayInstruments for road network navigationRoad vehicles traffic controlAsset trackingComputer science

A system and method for describing local area geo-reference features and landmarks in providing high resolution asset location information. Geo-image data is integrated to a mapping application and geo-reference data to add more detailed scale levels to the map. The geo-image data includes geo-images and its features to provide more detailed references to the asset and support the larger references of the geo-reference data. To describe a geo-reference landmark, an original landmark representation is selected with a center point and a radius. The asset location points located at the original landmark representation are compiled along with the asset location points generated by events occurring at the landmark to create a point set. The point set replaces the original landmark representation when a prescribed number of points is reached. The asset location points that are within a specified distance from any of the points in the point set are added to the point set to complete the landmark representation. The geo-image data and landmark representation data are combined to provide high resolution asset location information.

Owner:ASSET INTELLIGENCE

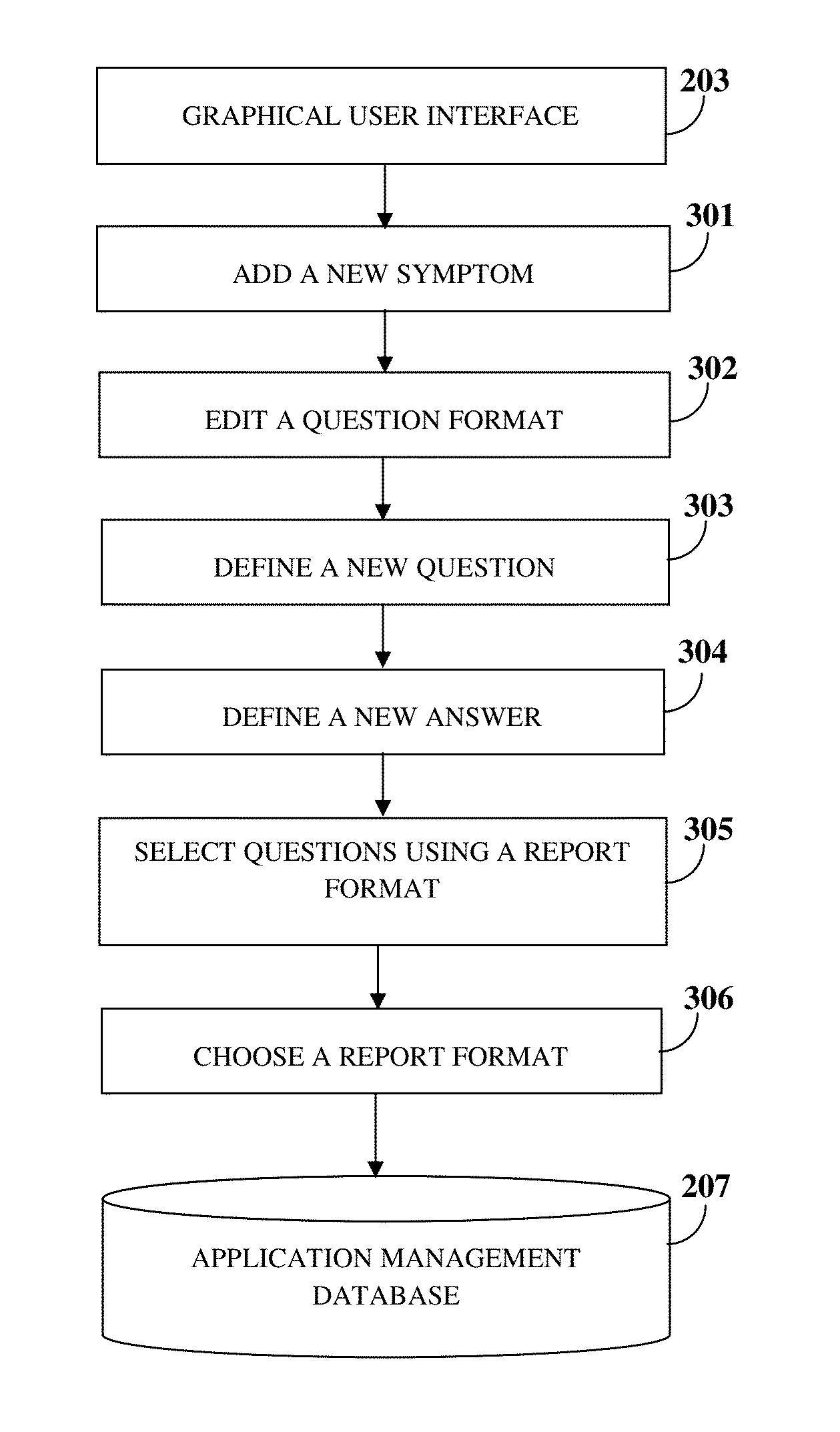

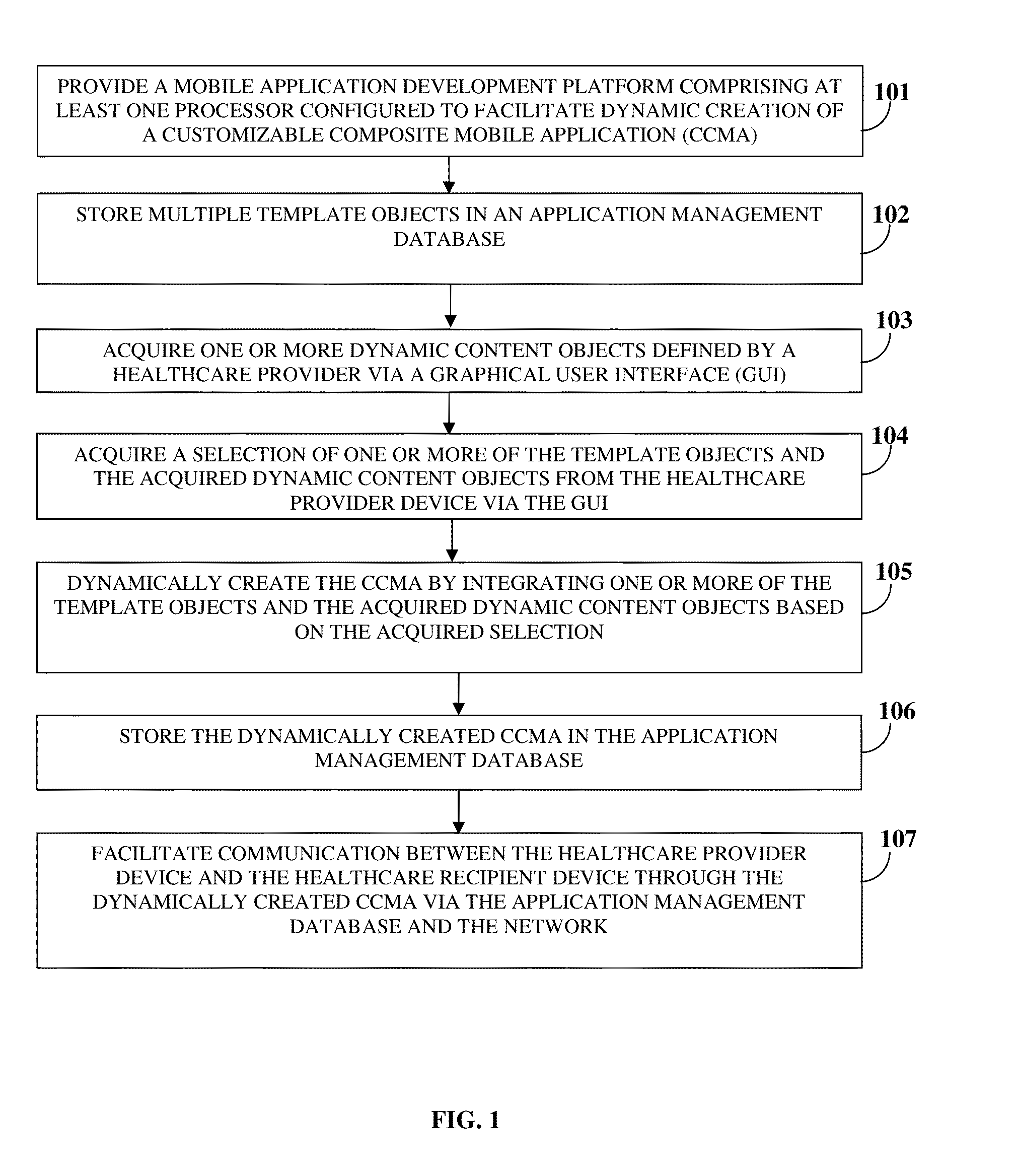

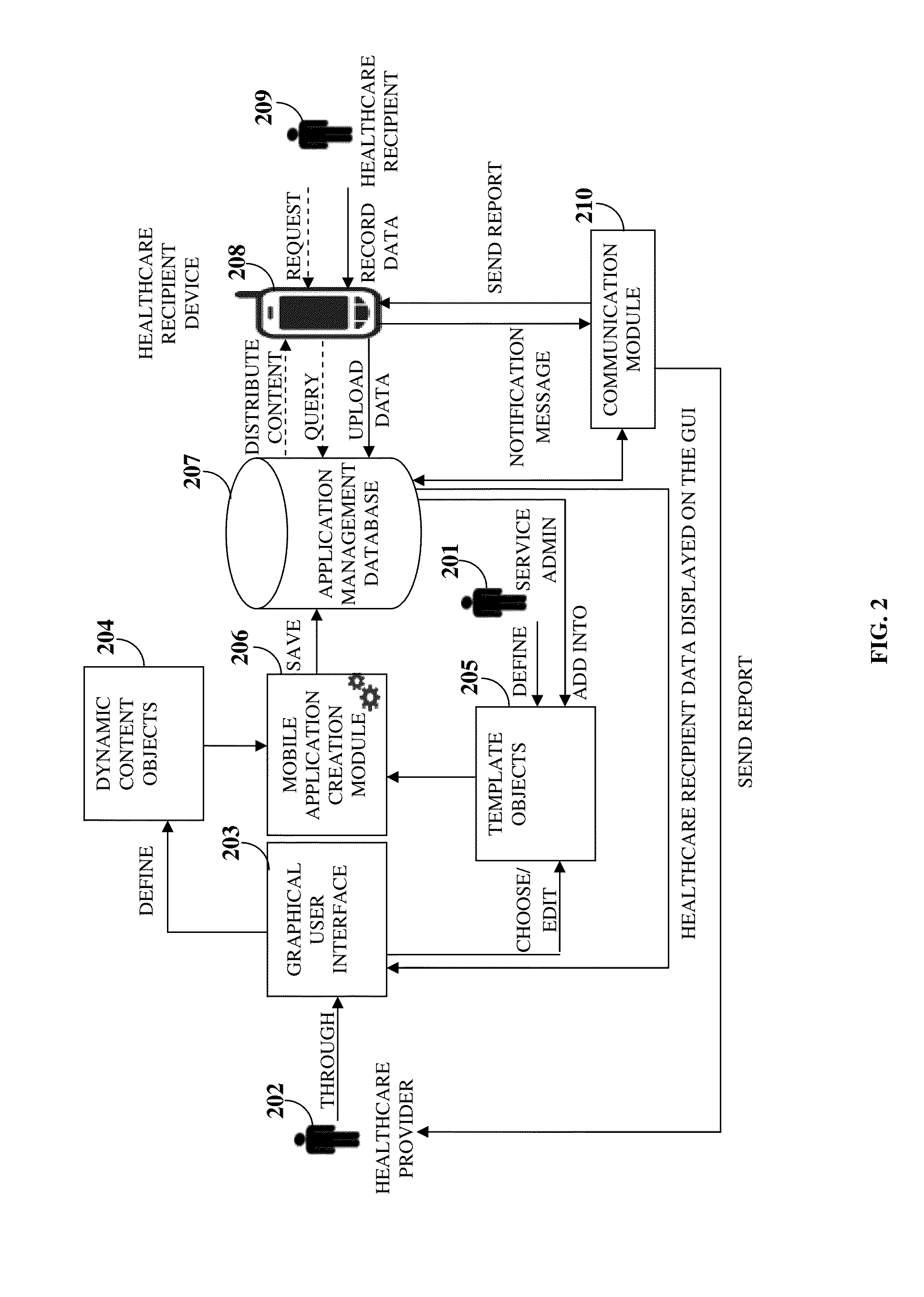

Mobile Healthcare Development, Communication, And Management

InactiveUS20140278536A1Facilitate communicationFacilitates and strengthens a healthcare provider's careData processing applicationsTelemedicineApplication softwareComputer science

A computer implemented method and system provides a mobile application development platform (MADP) for dynamically creating a healthcare provider specific customizable composite mobile application (CCMA) and monitoring healthcare elements of a healthcare recipient using the CCMA. The MADP is accessible by a healthcare provider device and a healthcare recipient device via a network. The MADP stores multiple template objects, for example, sub-applications that perform tasks for monitoring the healthcare elements in an application management database (AMD). The MADP acquires a selection of one or more template objects and one or more dynamic content objects defined by a healthcare provider and dynamically creates the CCMA by integrating the selected template objects and dynamic content objects. The MADP stores the CCMA in the AMD. The CCMA facilitates communication between the healthcare provider device and the healthcare recipient device for monitoring the healthcare elements of the healthcare recipient.

Owner:BLUEJAY MOBILE HEALTH

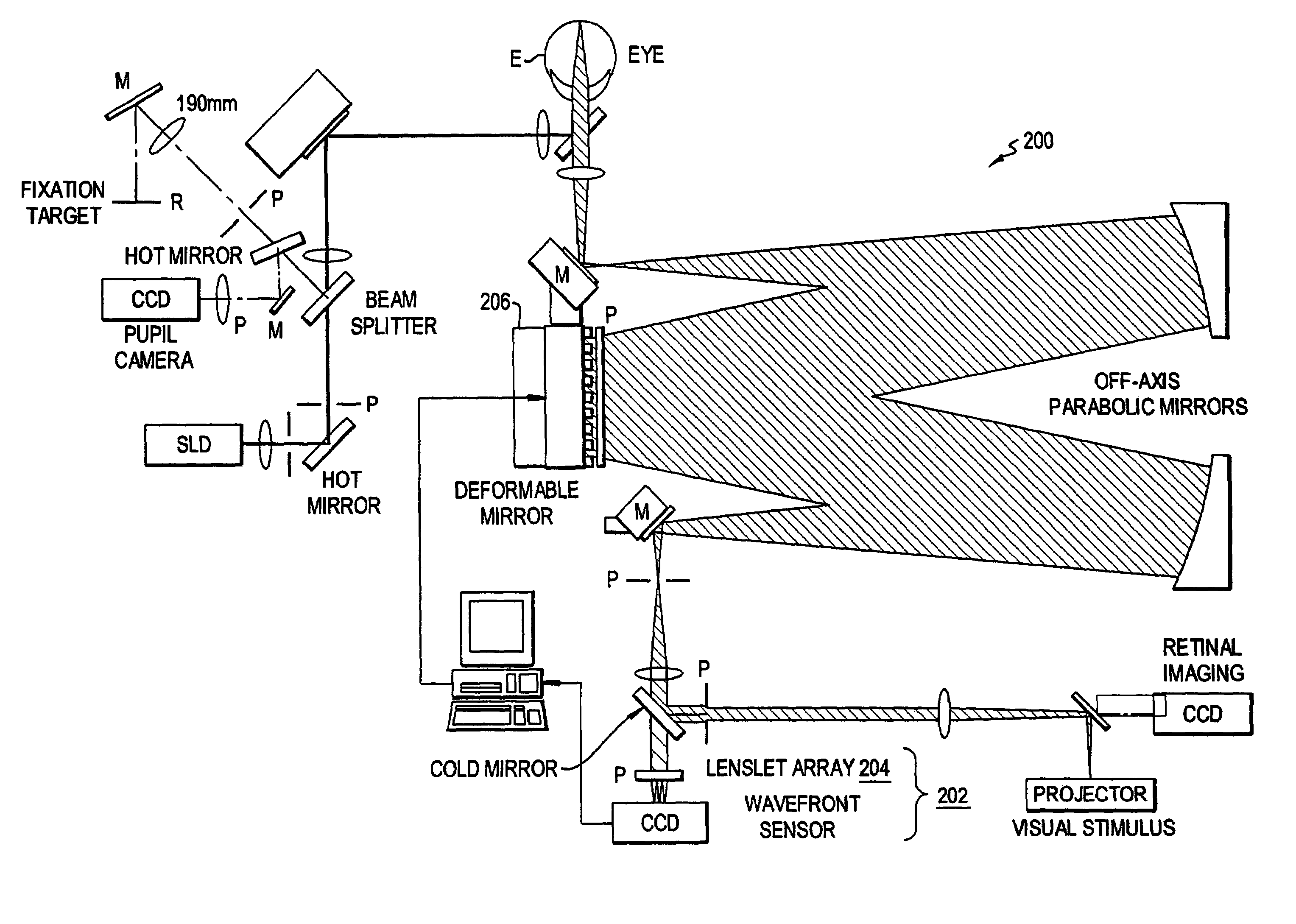

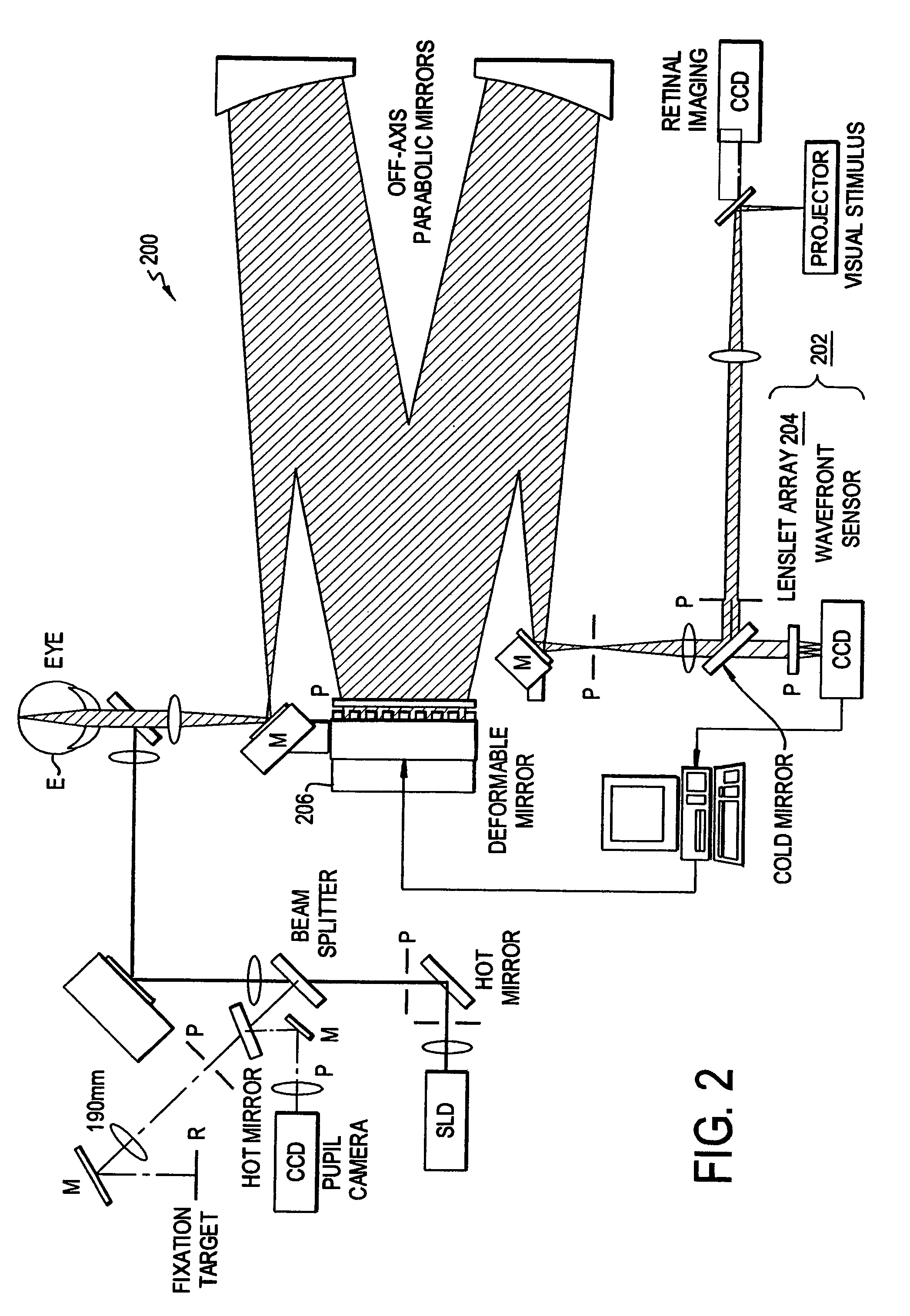

Sharpness metric for vision quality

InactiveUS7077522B2Remove wave aberrationSubjective blurRefractometersSkiascopesQuality of visionPoint spread function

A vision metric, called the sharpness metric, indicates the subjective sharpness of a patient's vision by taking into account both the wavefront aberration and the retinal response to the image. A retinal image quality function such as the point spread function is convolved by a neural quality function, and the maximum of the convolution over the retinal plane provides the sharpness metric. The sharpness metric can be used to control eye surgery or the fabrication of a lens.

Owner:UNIVERSITY OF ROCHESTER

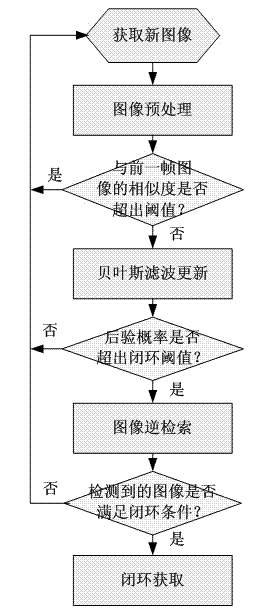

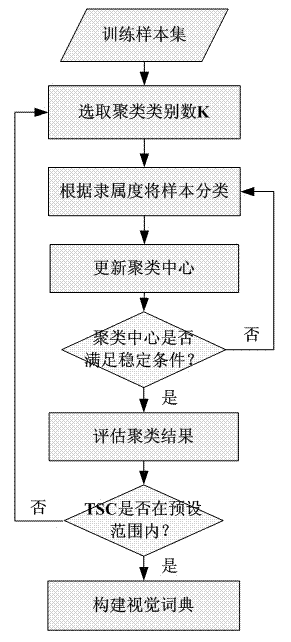

Image appearance based loop closure detecting method in monocular vision SLAM (simultaneous localization and mapping)

InactiveCN102831446AReduce the amount of calculationLower requirementCharacter and pattern recognitionPosition/course control in two dimensionsSimultaneous localization and mappingVisual perception

The invention discloses an image appearance based loop closure detecting method in monocular vision SLAM (simultaneous localization and mapping). The image appearance based loop closure detecting method includes acquiring images of the current scene by a monocular camera carried by a mobile robot during advancing, and extracting characteristics of bag of visual words of the images of the current scene; preprocessing the images by details of measuring similarities of the images according to inner products of image weight vectors and rejecting the current image highly similar to a previous history image; updating posterior probability in a loop closure hypothetical state by a Bayesian filter process to carry out loop closure detection so as to judge whether the current image is subjected to loop closure or not; and verifying loop closure detection results obtained in the previous step by an image reverse retrieval process. Further, in a process of establishing a visual dictionary, the quantity of clustering categories is regulated dynamically according to TSC (tightness and separation criterion) values which serve as an evaluation criterion for clustering results. Compared with the prior art, the loop closure detecting method has the advantages of high instantaneity and detection precision.

Owner:NANJING UNIV OF POSTS & TELECOMM

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com