Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

3772results about "Franking apparatus" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

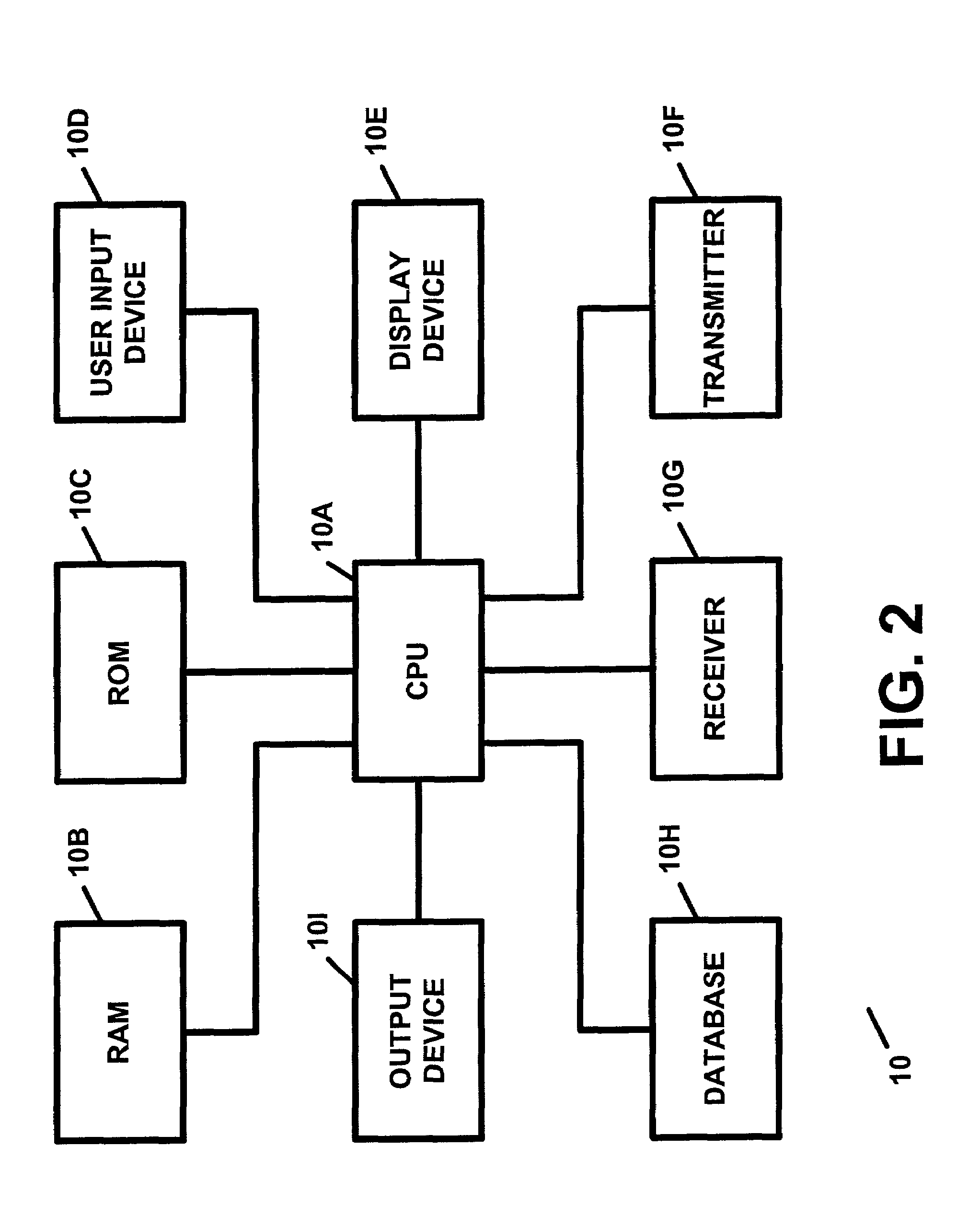

Content display monitor

InactiveUS6108637AComplete banking machinesDigital data information retrievalWeb siteComputerized system

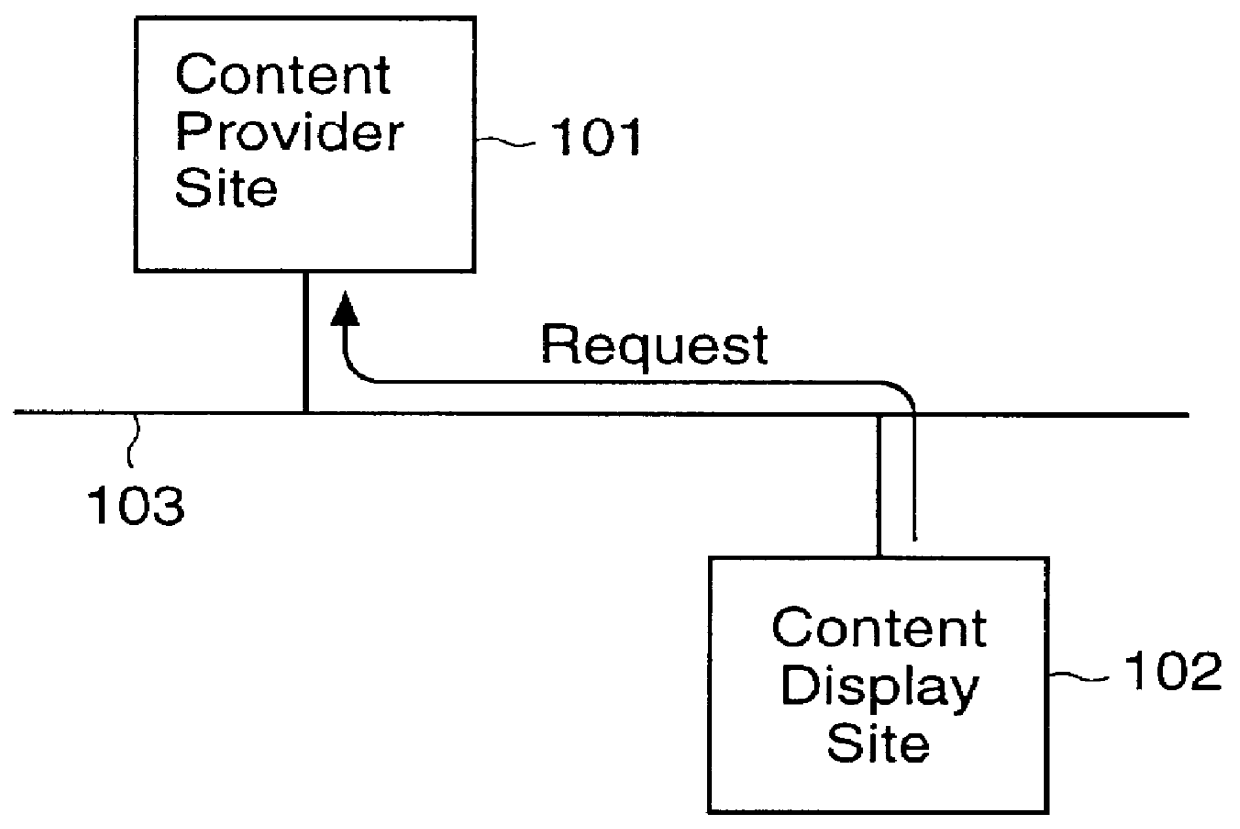

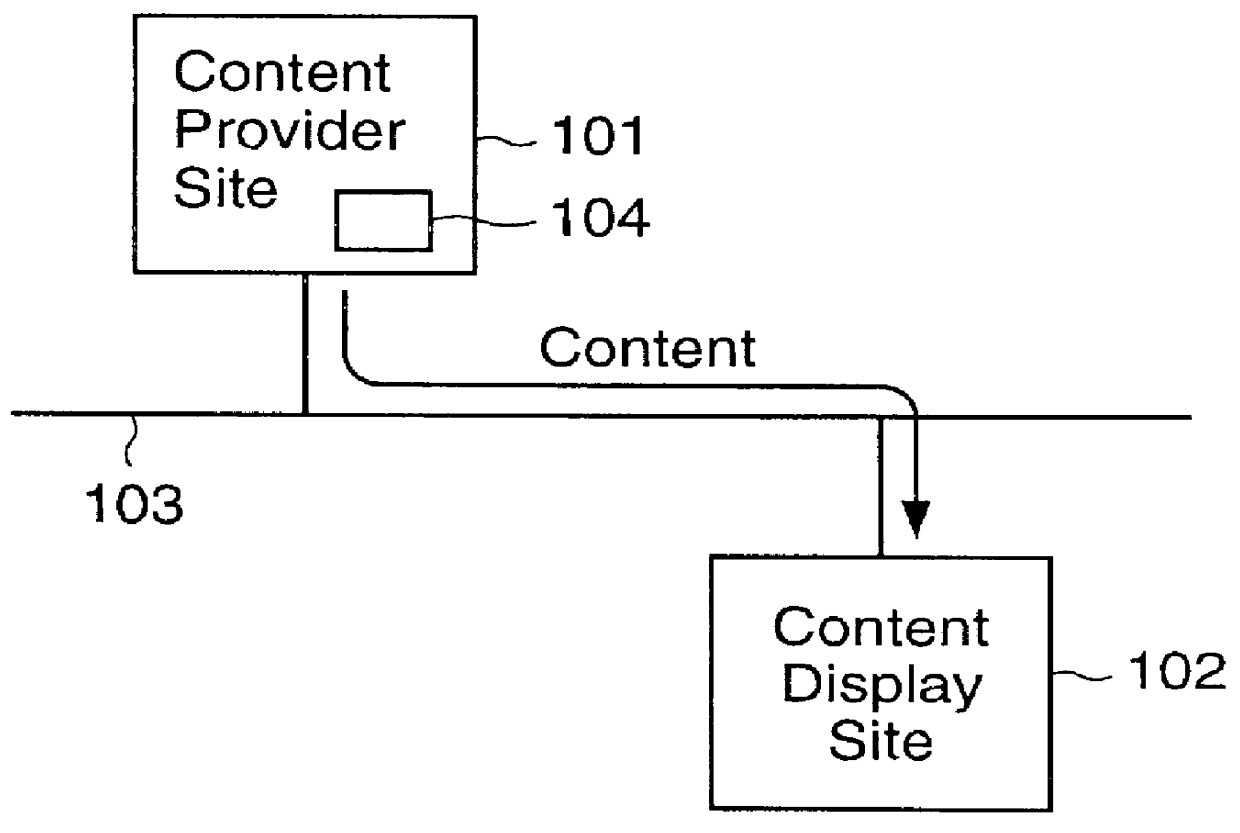

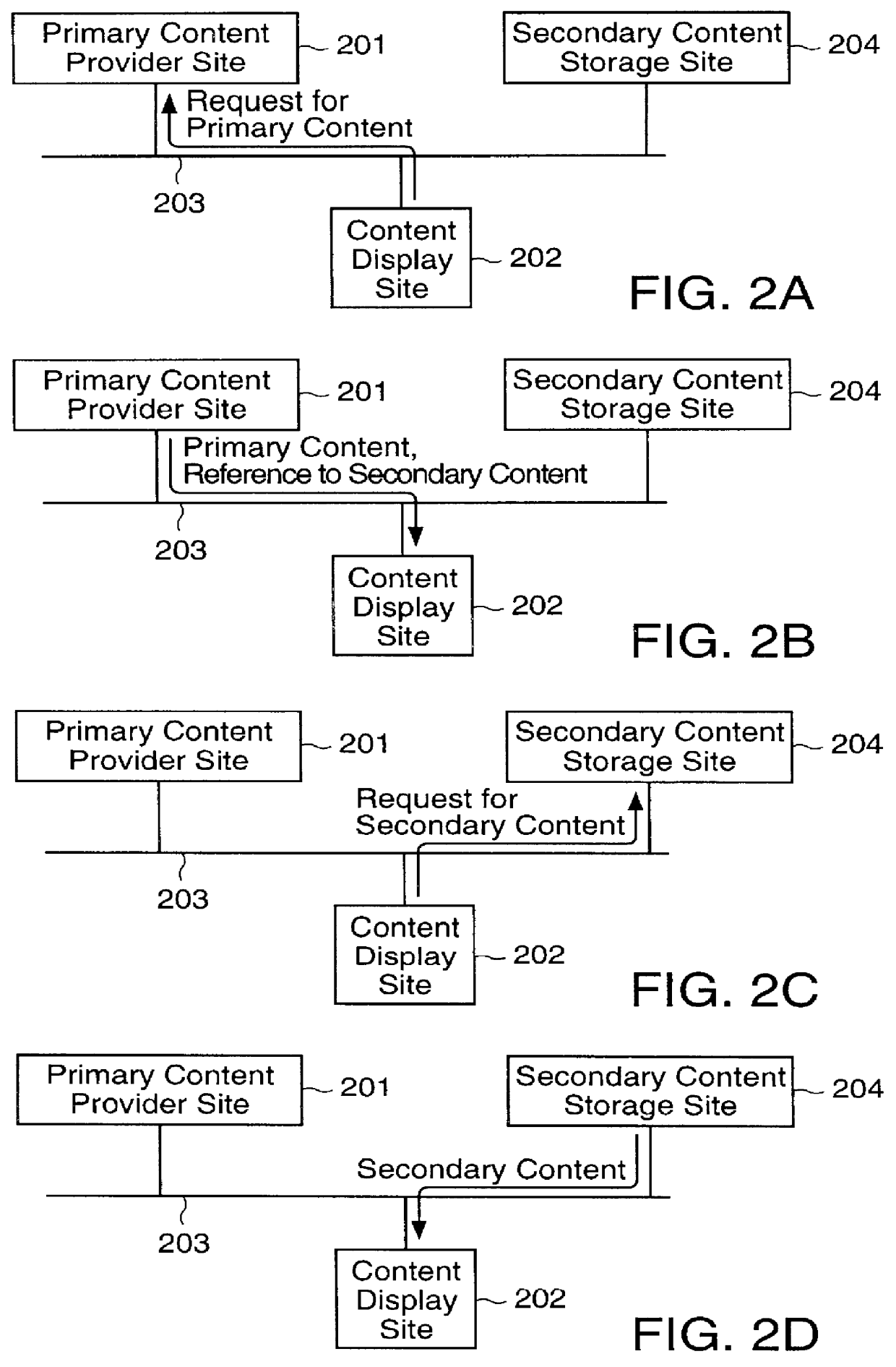

The invention can enable monitoring of the display of content by a computer system. Moreover, the invention can enable monitoring of the displayed content to produce monitoring information from which conclusions may be deduced regarding the observation of the displayed content by an observer. The invention can also enable monitoring of the display at a content display site of content that is provided by a content provider site over a network to the content display site. Additionally, the invention can enable the expeditious provision of updated and / or tailored content over a network from a content provider site to a content display site so that the content provider's current and appropriately tailored content is always displayed at the content display site. Aspects of the invention related to transfer of content over a network are generally applicable to any type of network. However, it is contemplated that the invention can be particularly useful with a computer network, including private computer networks (e.g., America Online TM ) and public computer networks (e.g., the Internet). In particular, the invention can be advantageously used with computer networks or portions of computer networks over which video and / or audio content are transferred from one network site to another network site for observation, such as the World Wide Web portion of the Internet.

Owner:NIELSEN COMPANY US LLC THE A DELAWARE LIMITED LIABILITY

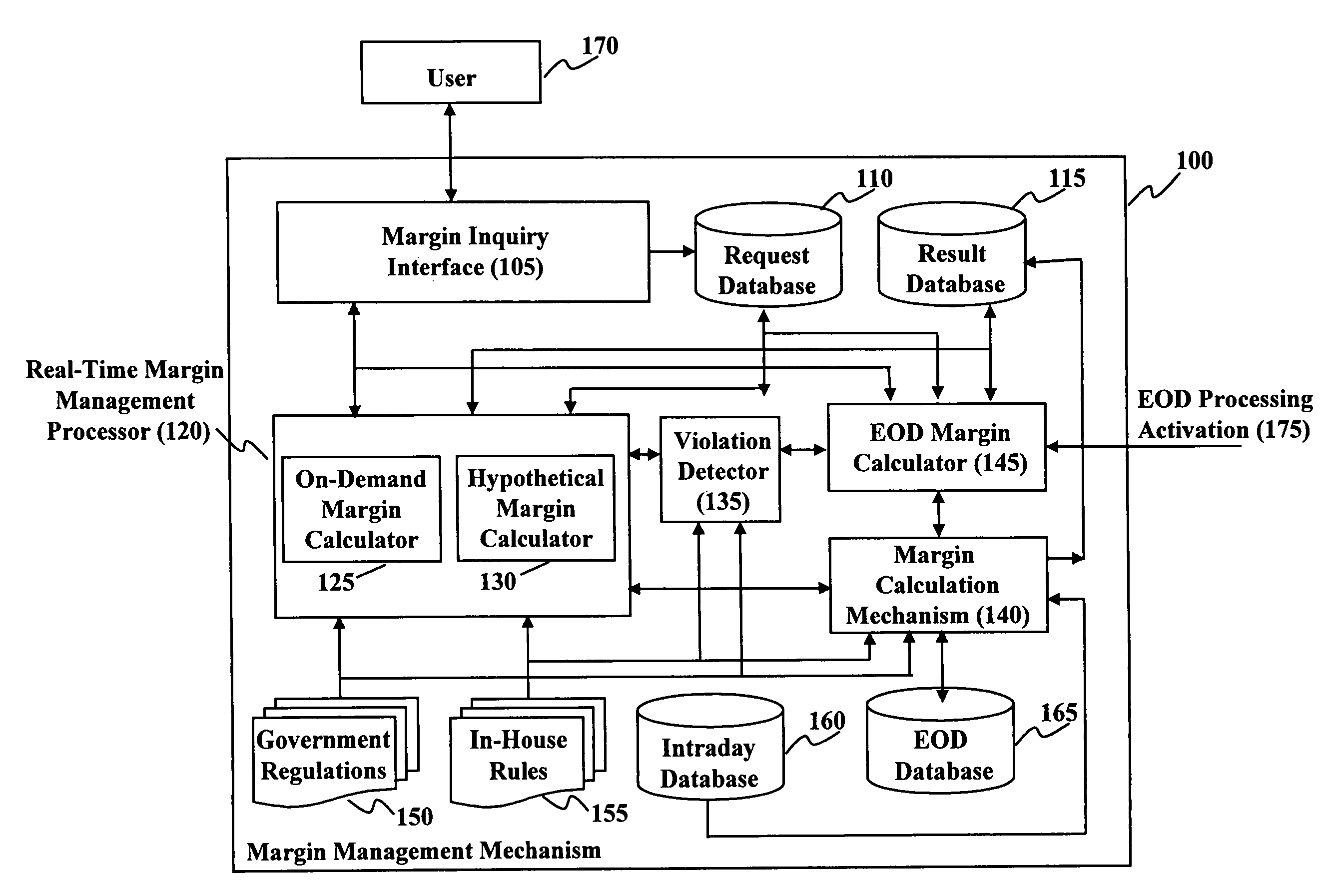

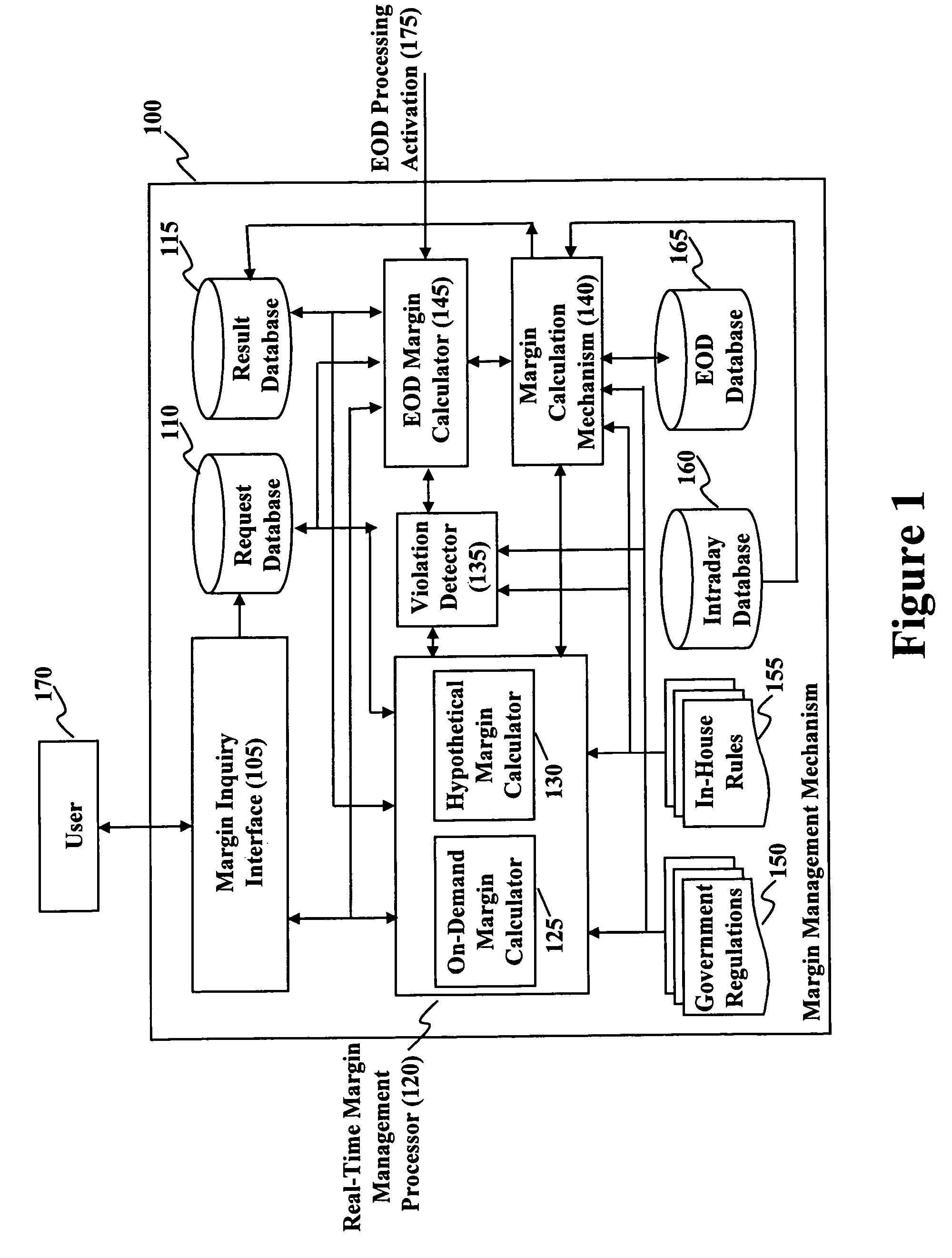

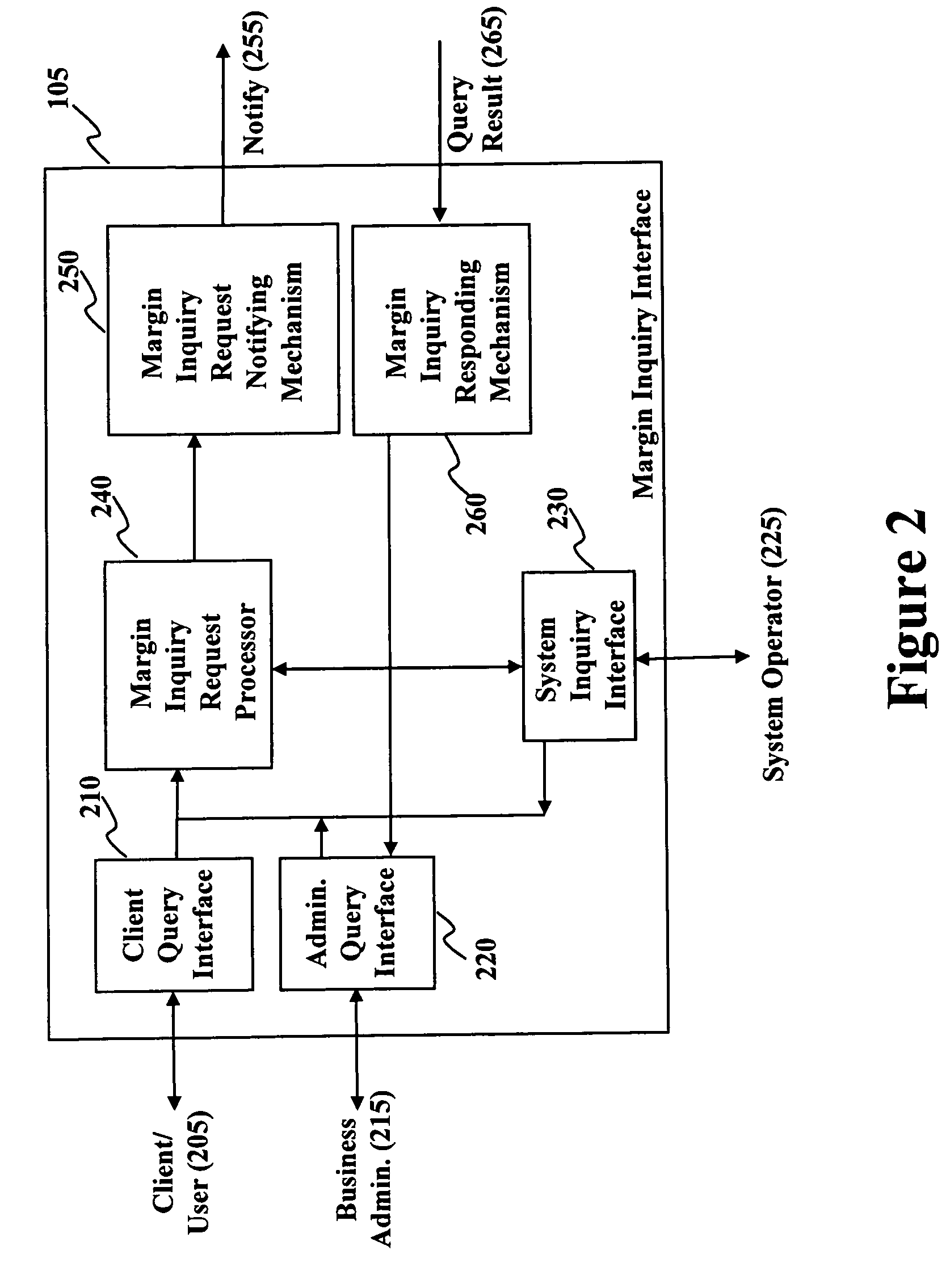

Method and system for real time margin calculation

Owner:UBS BUSINESS SOLUTIONS AG

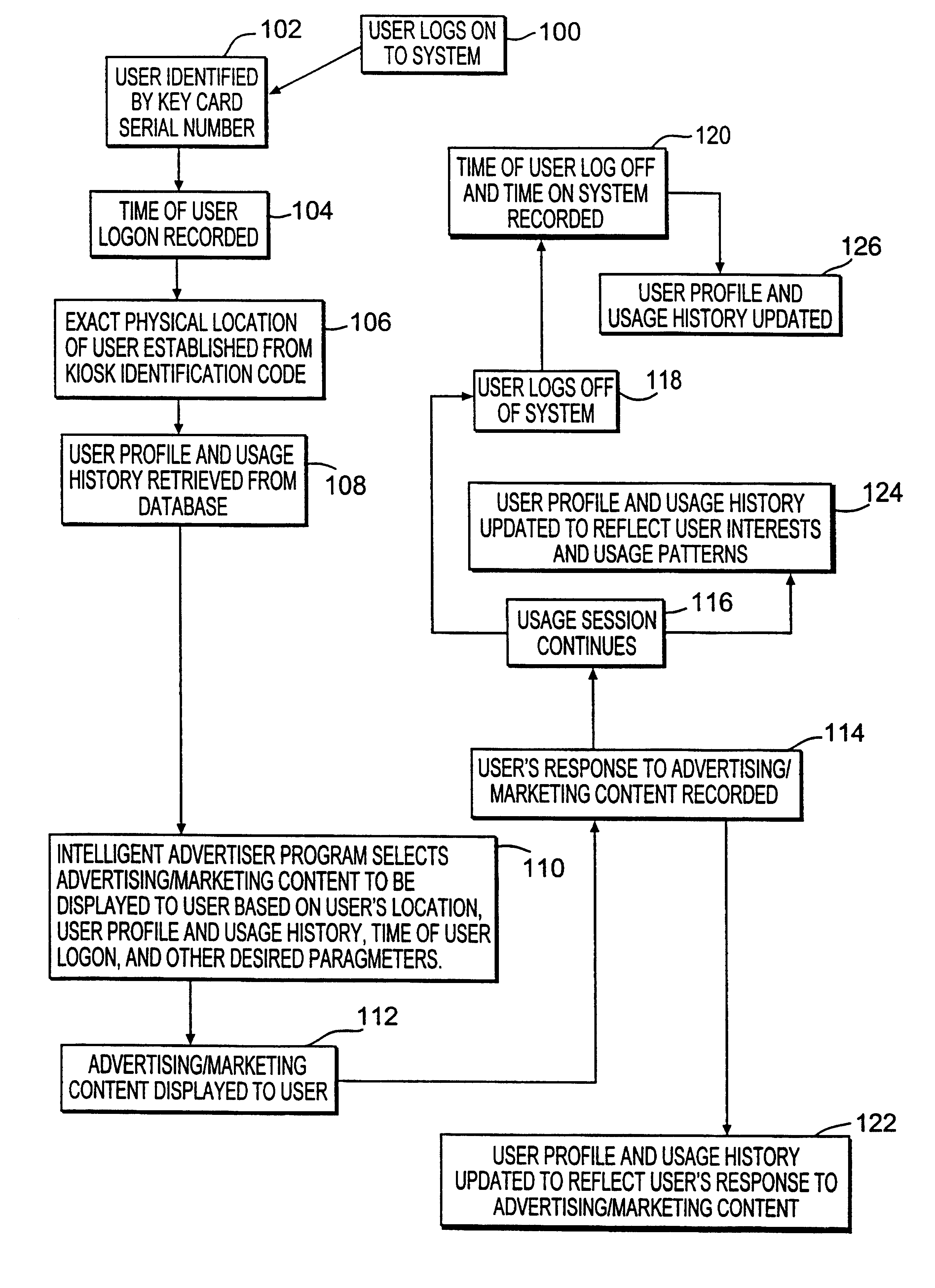

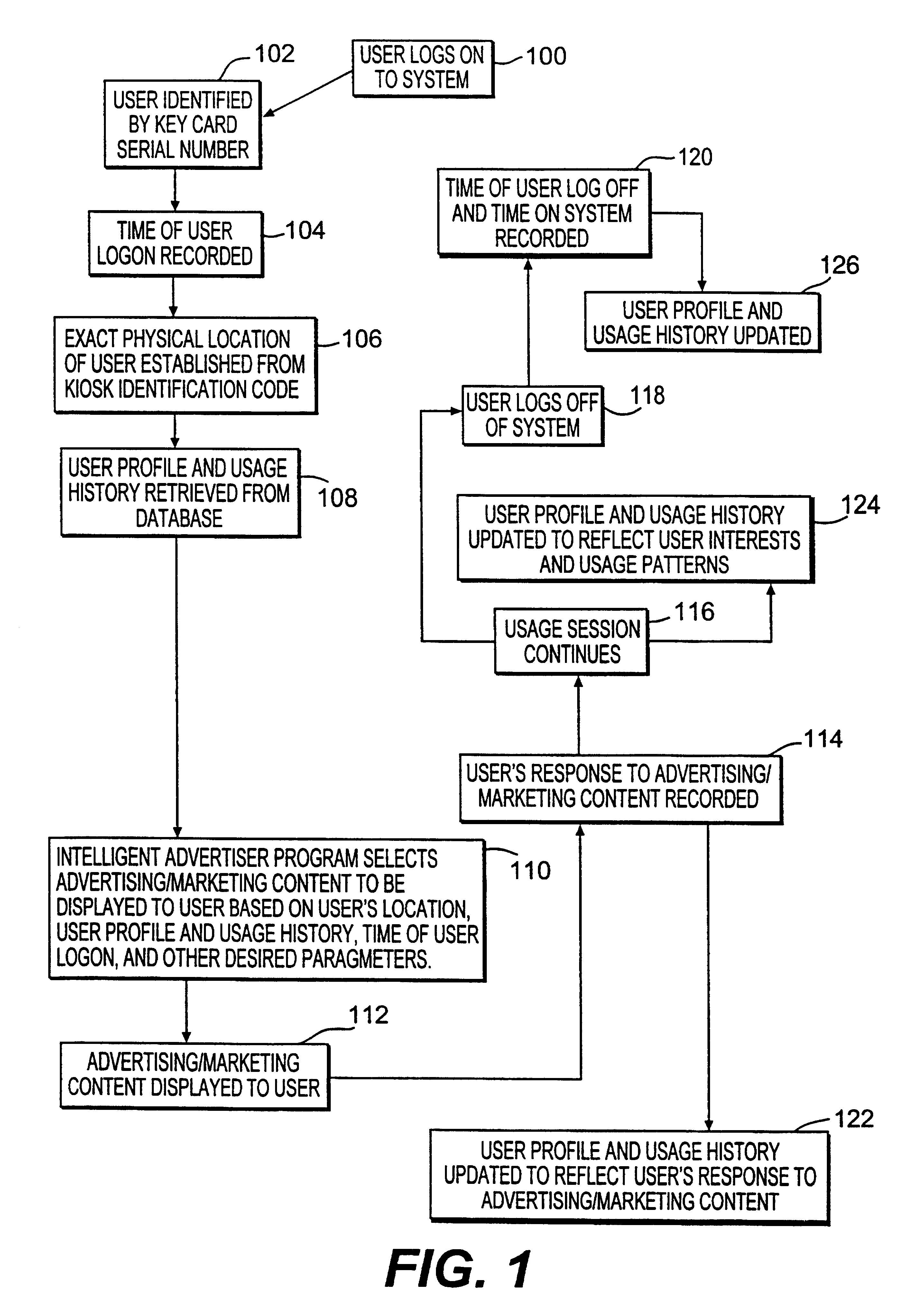

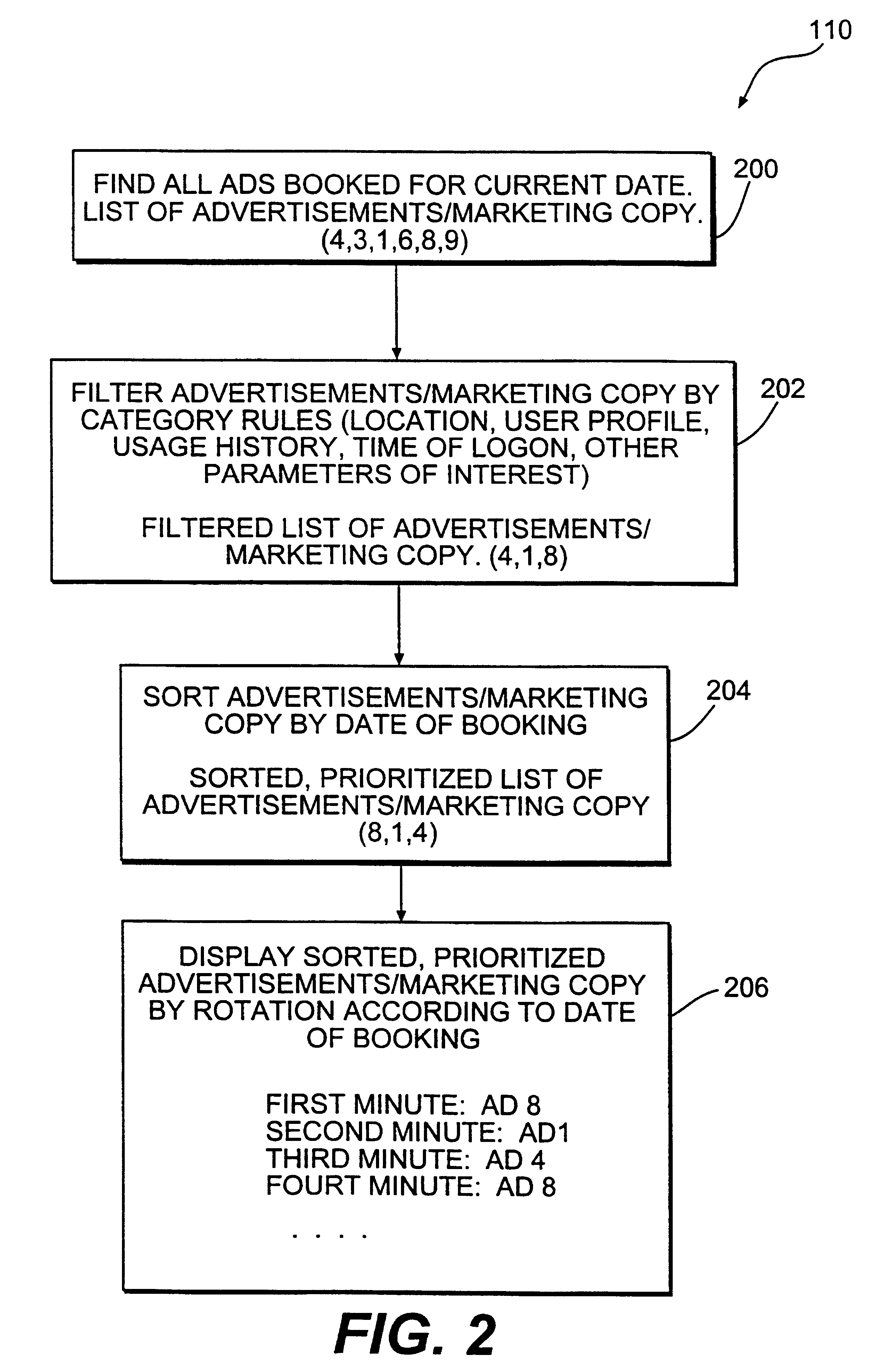

Method and system for providing personalized online services and advertisements in public spaces

InactiveUS6847969B1Without time-consuming searchingComplete banking machinesAcutation objectsPersonalizationPersonal details

A method and system for providing, personalized and integrated online services for communications and commercial transactions both in private and public venues. The invention provides personalized information that is conveniently accessible through a network of public access stations (or terminals) which are enabled by a personal system access card (e.g., smart card). The invention also provides advertisers the opportunity to directly engage action; and potential user-consumers with selected advertising or marketing content based on each user's profile and usage history.

Owner:STREETABPACE

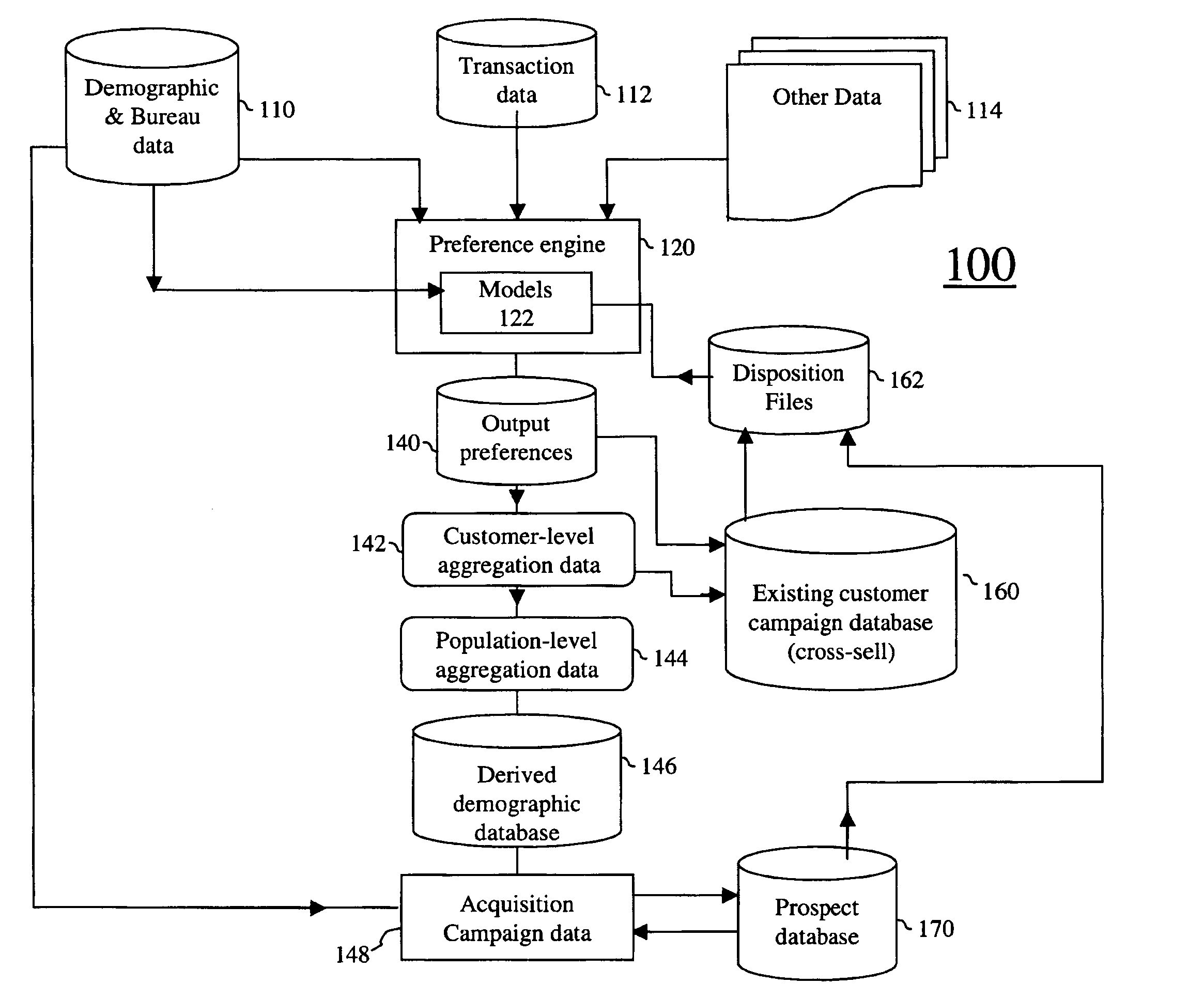

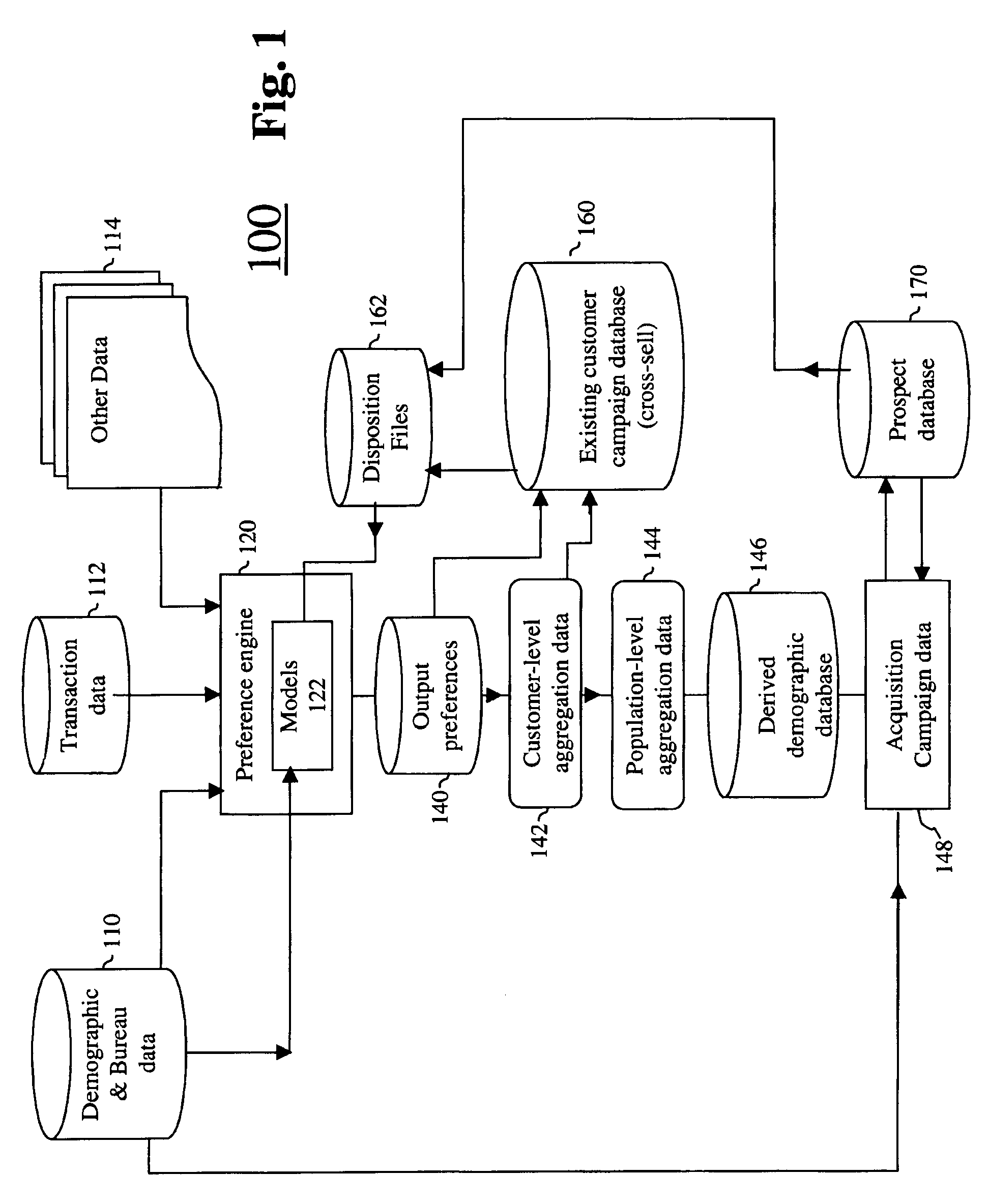

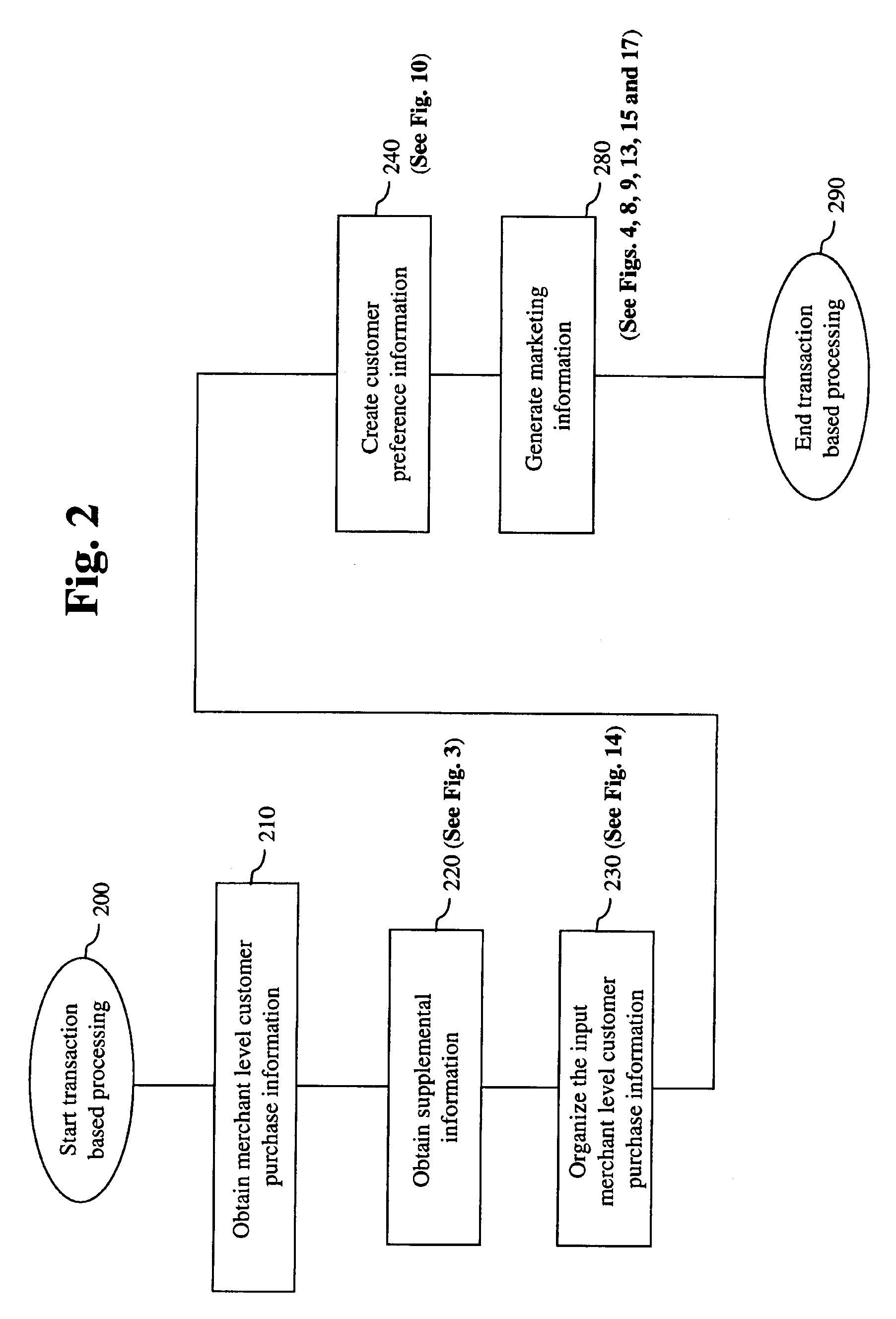

Systems And Methods For Aggregating And Utilizing Retail Transaction Records At The Customer Level

A method and system is provided for storing and manipulating customer purchase information received from a plurality of sources. A computer system may be used comprising a storage device for storing the customer purchase information and a processor for processing the customer purchase information. The method may include receiving the customer purchase information; organizing the customer purchase information within a predetermined organizational structure; creating a customer preference based at least in part on the customer purchase information; and aggregating customer purchases for merchant classes based on the customer purchase information so as to generate aggregated customer purchase information. The method may further include generating marketing information based on at least one of the customer preference and the aggregated customer purchase information.

Owner:CHASE BANK USA NAT ASSOC +1

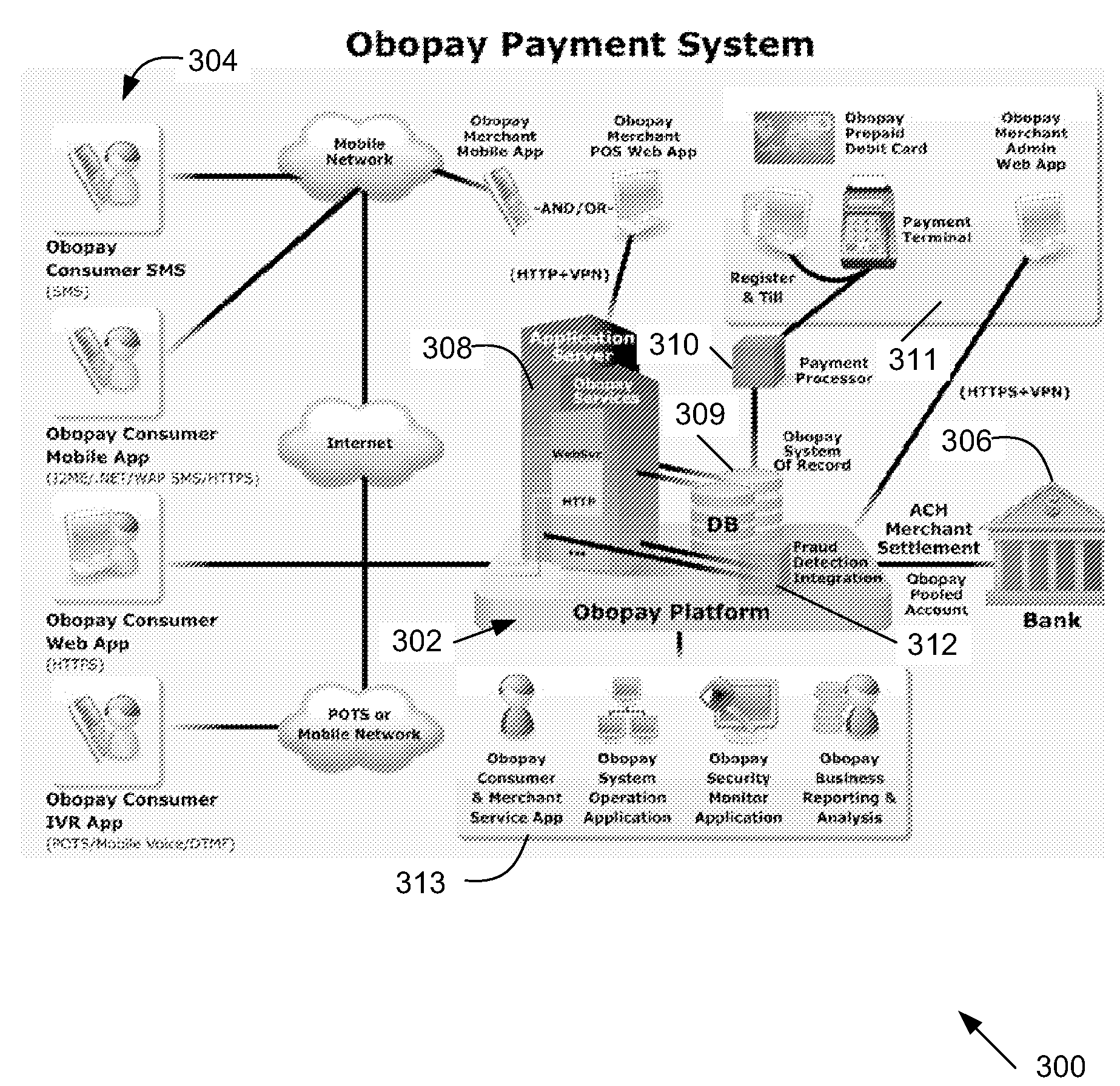

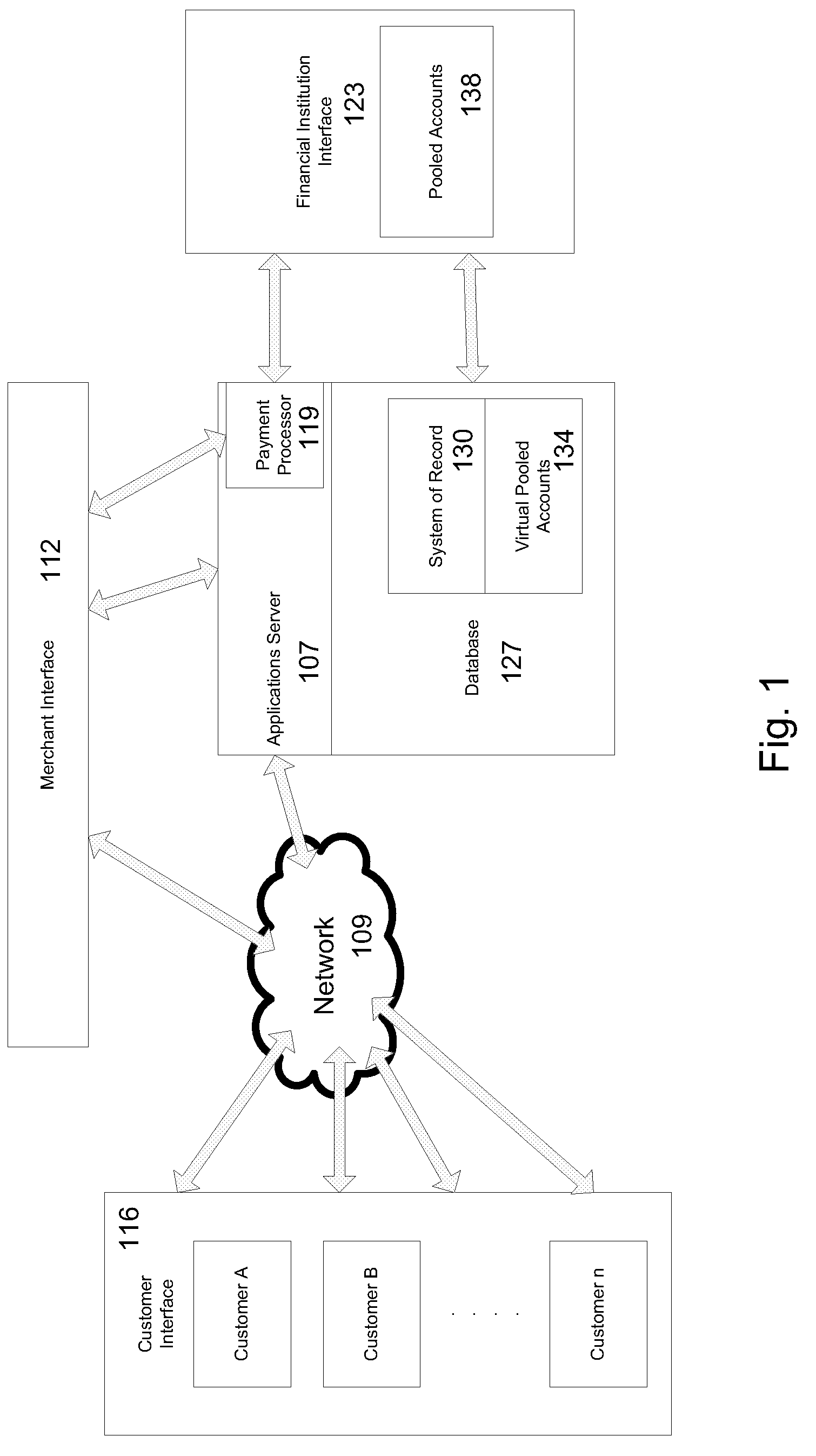

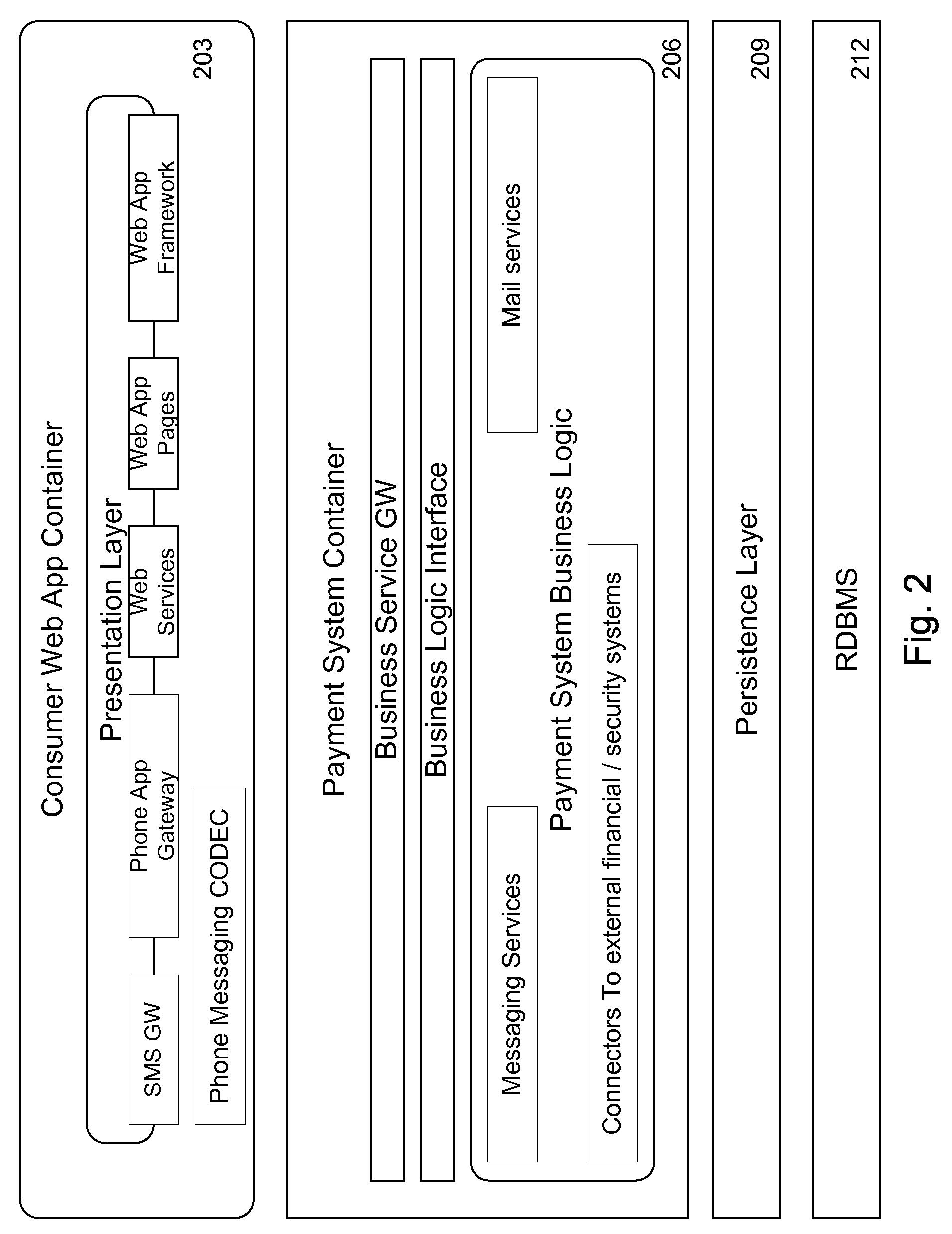

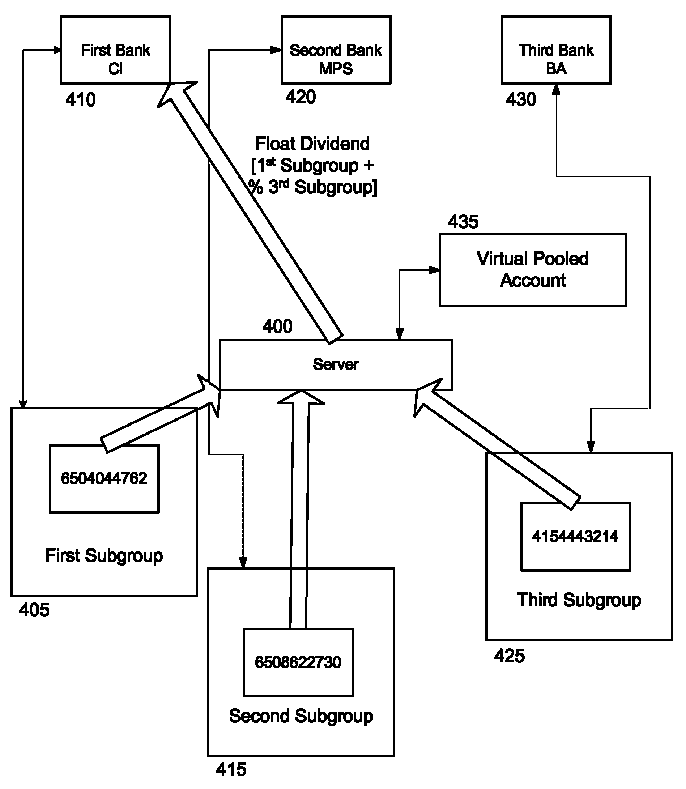

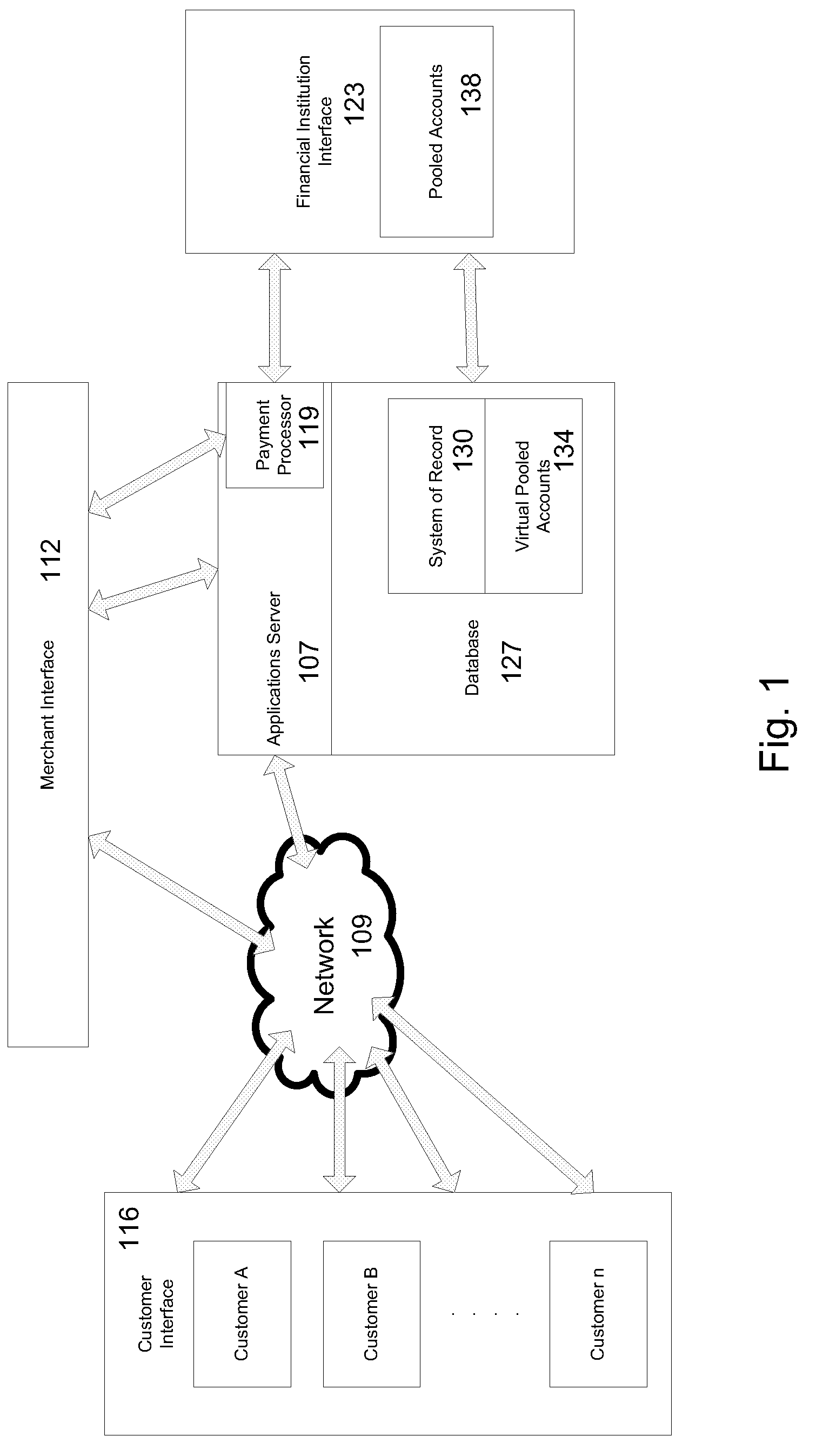

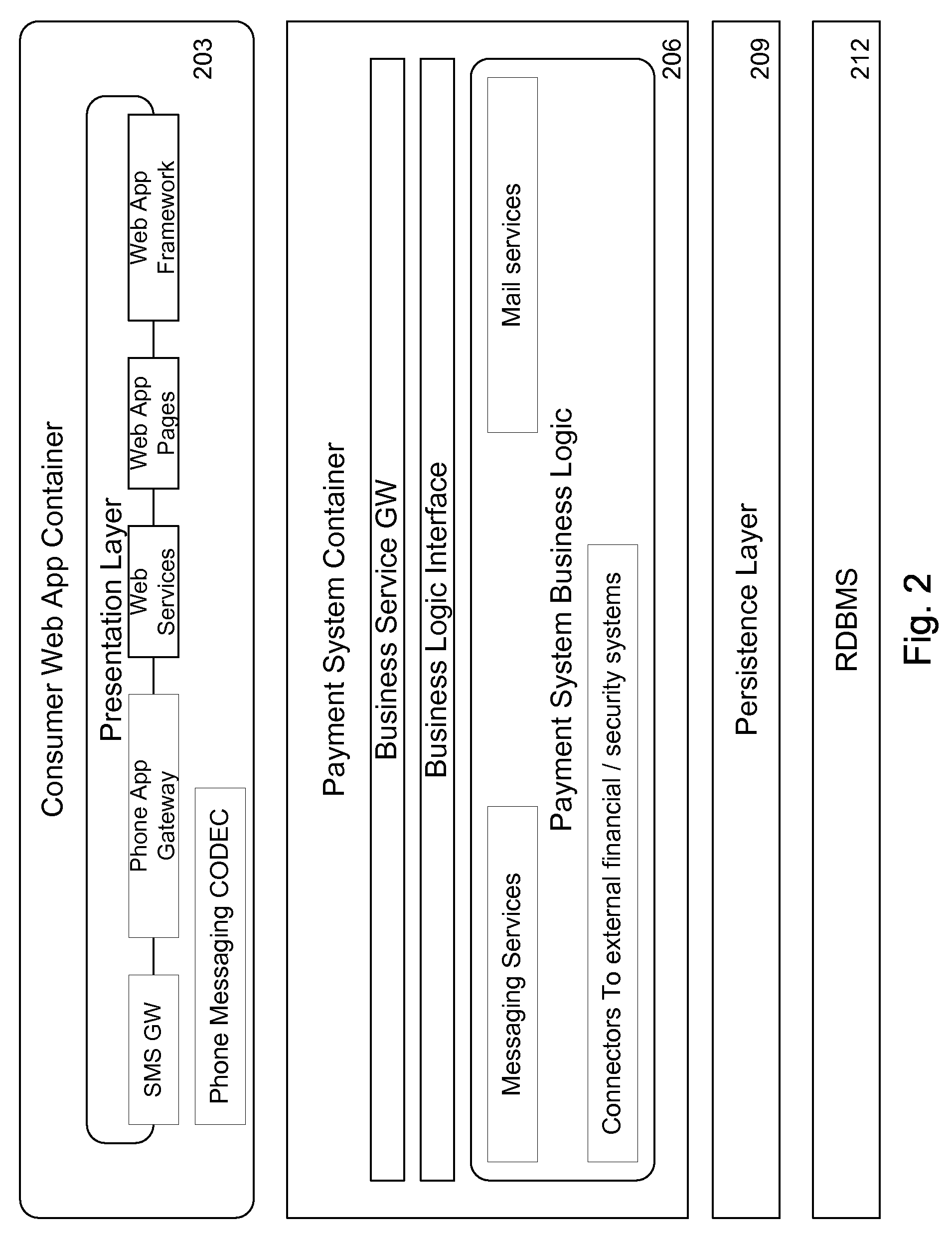

Virtual Pooled Account for Mobile Banking

InactiveUS20090119190A1Reduce settlementReduce operating costsComplete banking machinesFinanceOperational costsSimulation

A virtual pooled account is used in operating a system having multiple financial partners. In a specific implementation, the system is a mobile banking system. Instead of maintaining separate general ledgers for each financial institution, the system will keep one general virtual pooled account. This will reduce the settlement and operational costs of the system. The owner of the virtual pooled account will receive the float on the virtual pooled account, and this float will be distributed to the multiple financial partners according to a formula.

Owner:OBOPAY MOBILE TECH INDIA PTE LTD

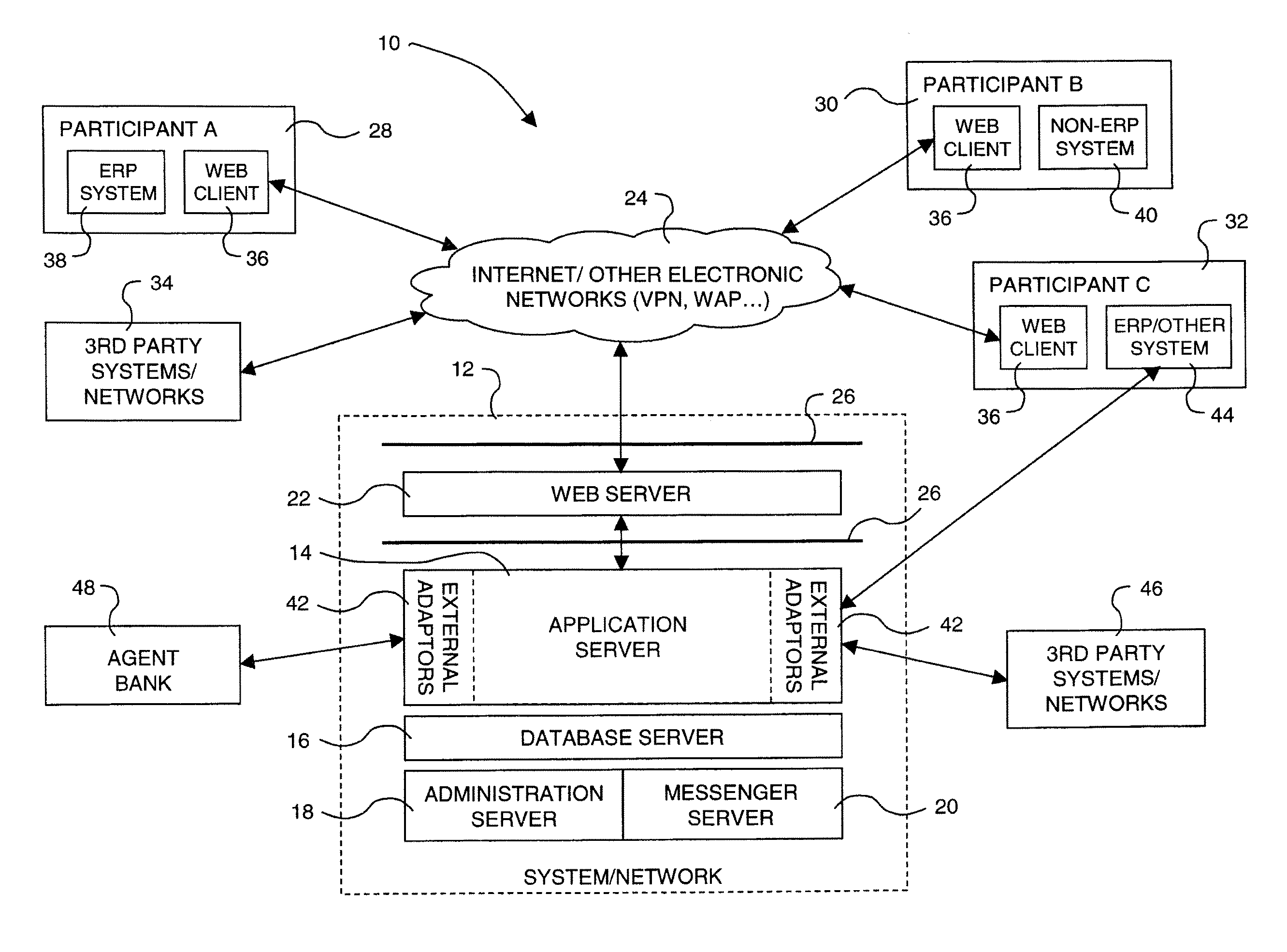

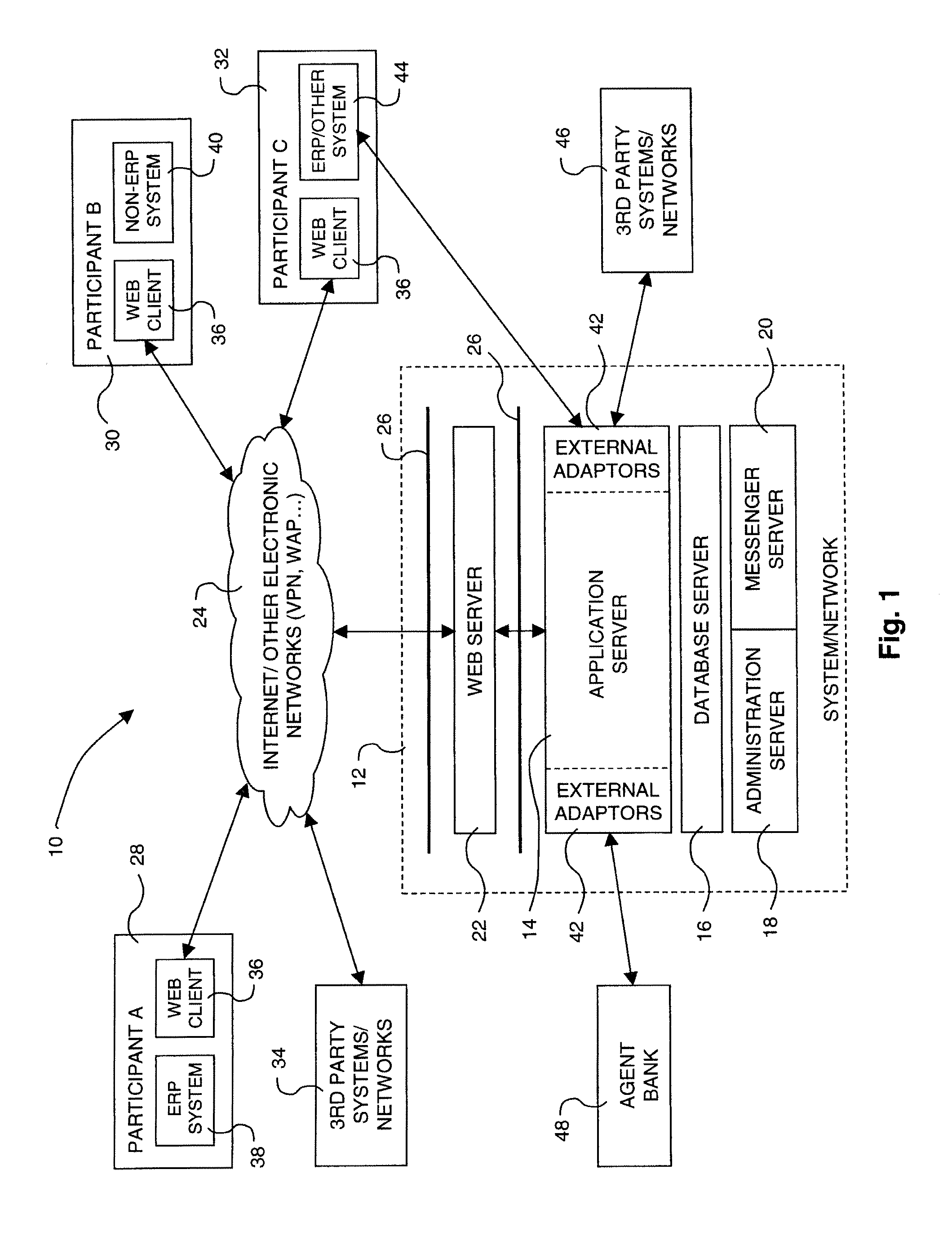

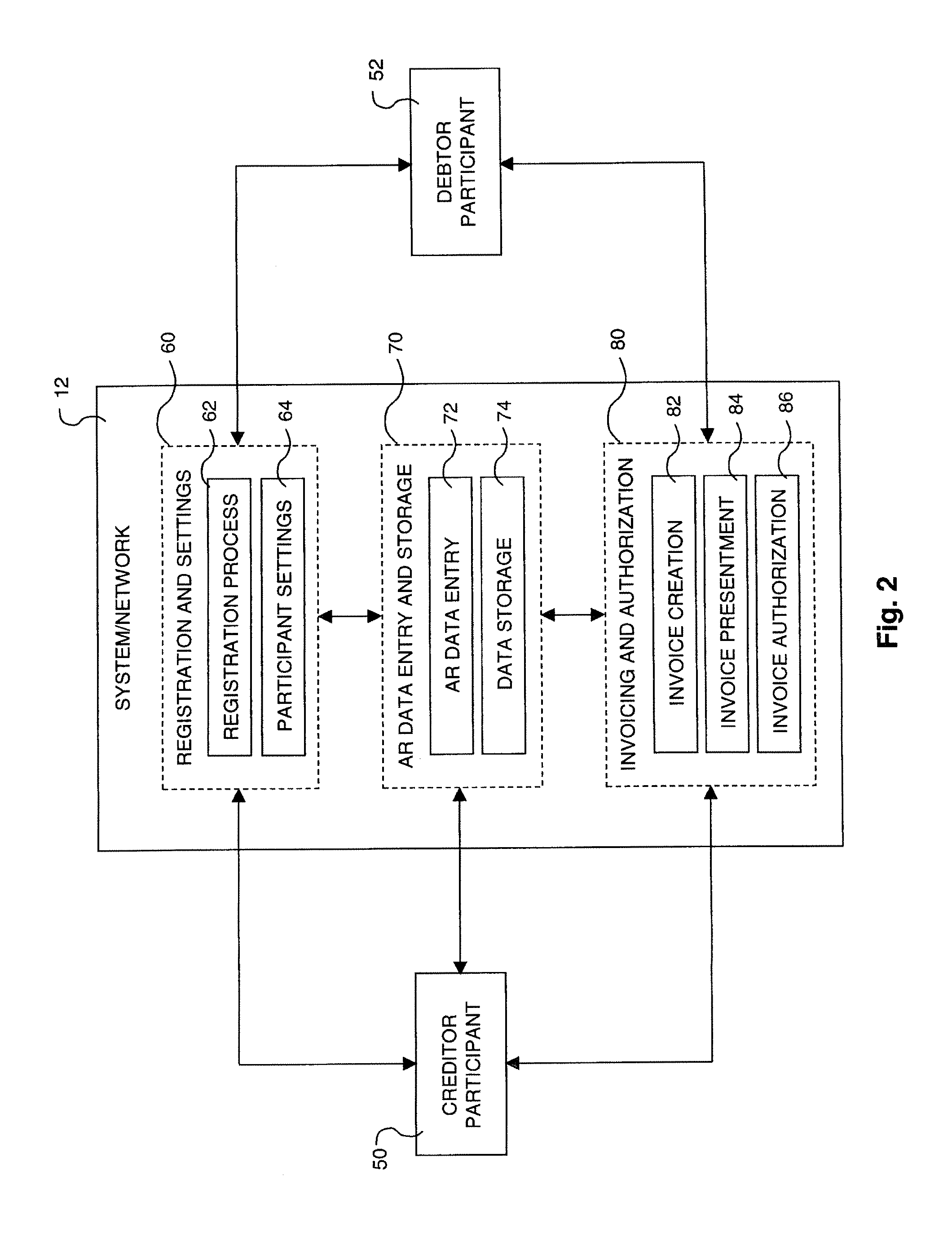

Electronic multiparty accounts receivable and accounts payable system

InactiveUS7206768B1Facilitating collection and trackingFacilitate communicationComplete banking machinesFinanceAccounts payableInvoice

The invention concerns a multiparty accounts receivable and accounts payable system that allows business trading partners to use a single, shared system for both accounts receivable and accounts payable management. The system of the invention forms an electronic “bridge” between a plurality of business trading partners for purposes of invoicing, dispute resolution, financing, and settlement of single and multiple currency debts. As the invoicing and settlement activities of the participants are funneled through a common system, the system allows a participant to aggregate all debts owed to other participants, aggregate all debts owed by the other participants, and net debts owed to other participants with debts owed by these participants. After aggregation and netting, the participant issues a single payment to settle numerous accounts payable items, and receives a single payment that settles numerous accounts receivable items. The system allows participants to use the substantial amount of financial and cash flow information captured by the system to borrow more efficiently by permitting lenders to view this information. Furthermore, the system provides a confirmation process to convert existing debt obligations into a new, independent payment obligation due on a date certain and free of any defenses to the underlying contract. The confirmed debt obligations provide a better source of working capital for the participants, or can be converted into electronic promissory notes. The system provides an electronic exchange for electronic promissory notes, allowing participants to raise working capital in various ways, for example, by selling them.

Owner:JPMORGAN CHASE BANK NA +1

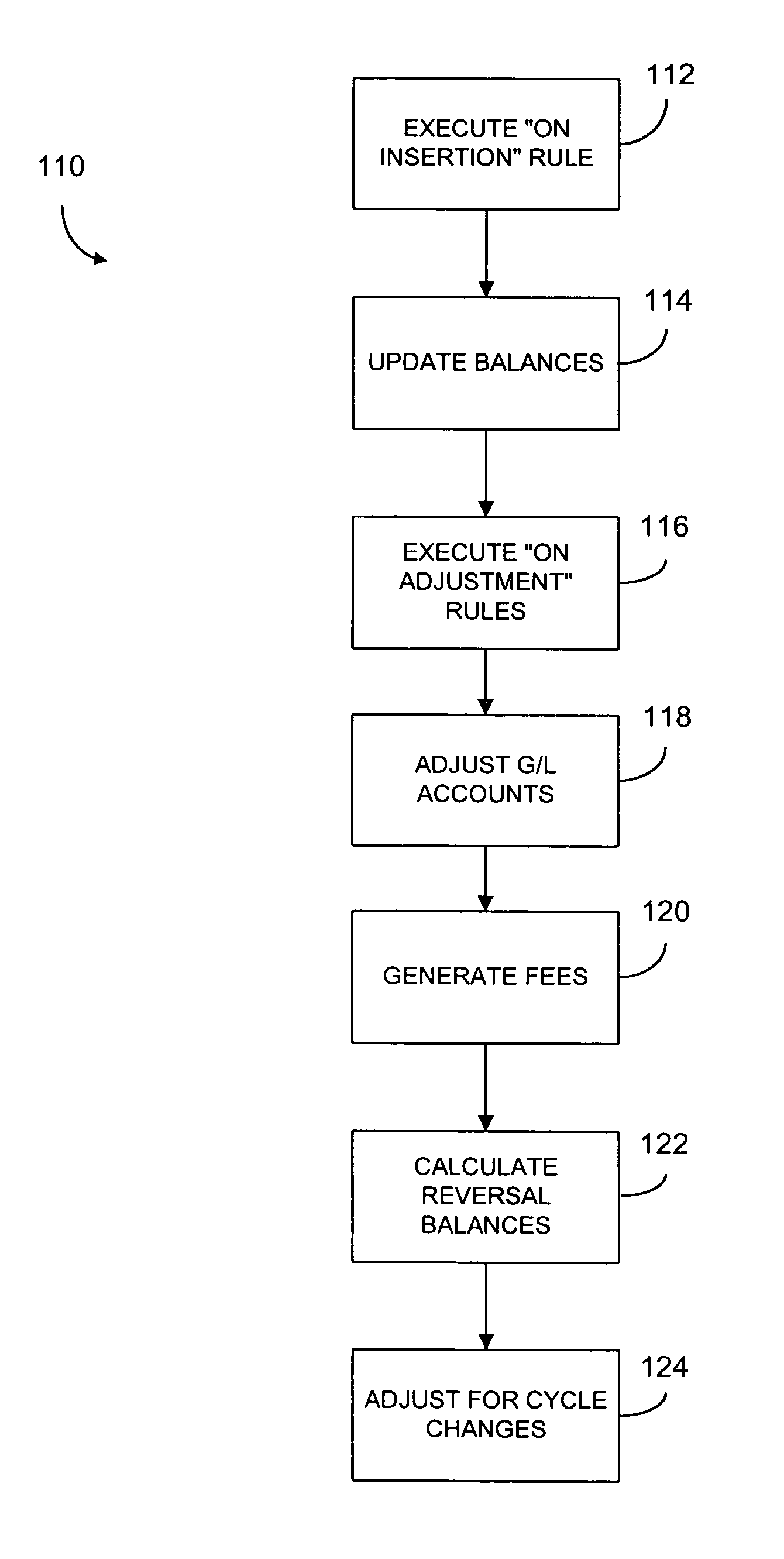

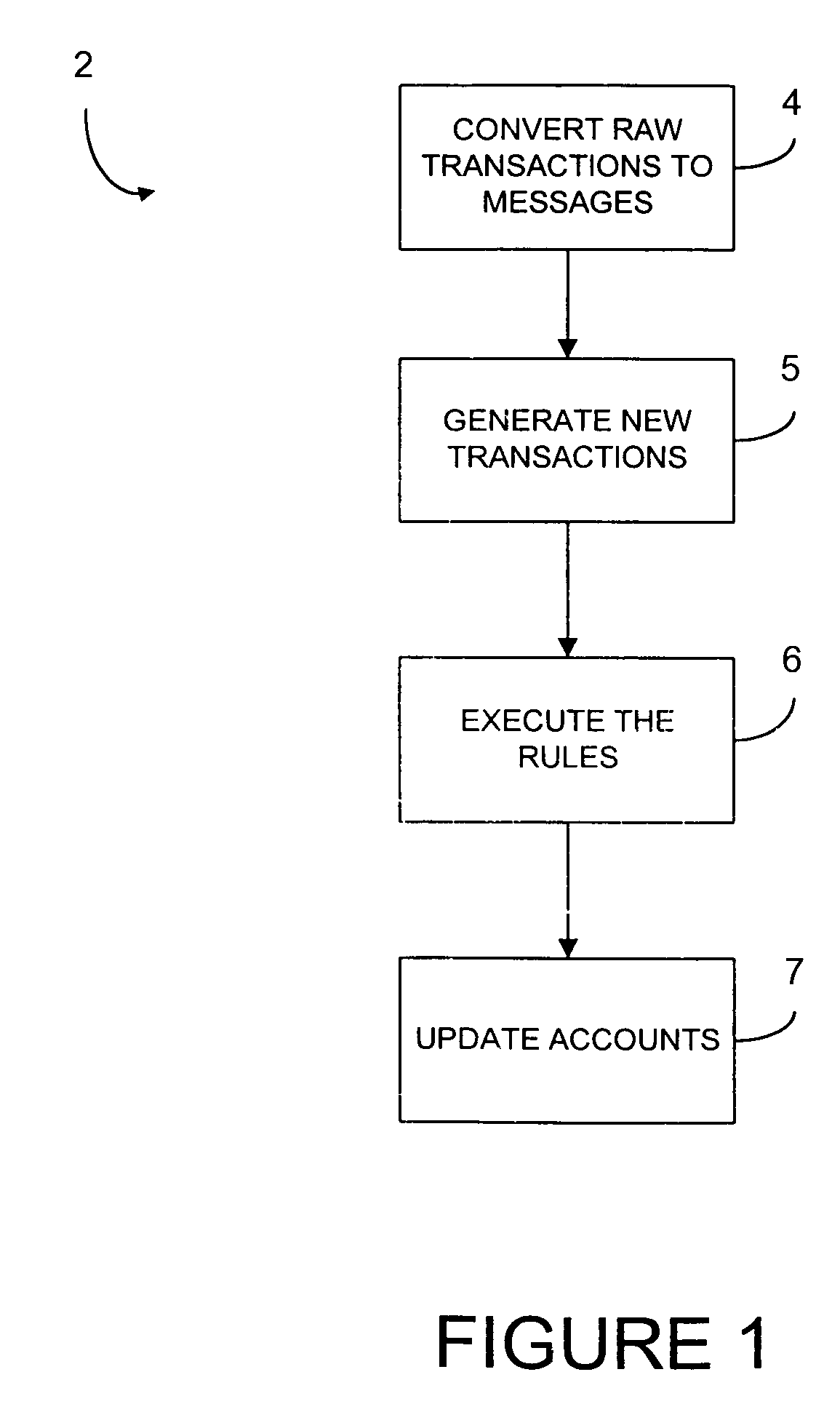

Methods and systems for managing financial accounts

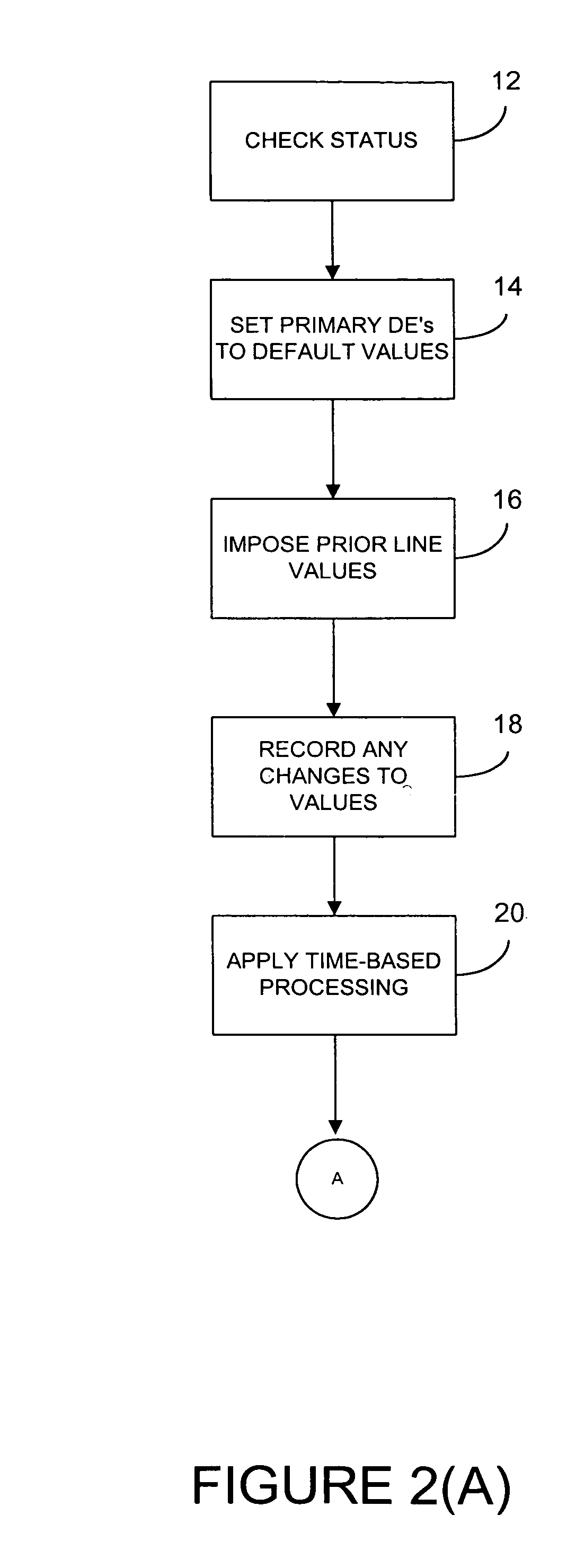

InactiveUS7117172B1Useful managingReduce in quantityComplete banking machinesFinanceSource codeParameter control

Processing systems and methods receive events, such as a transaction to an account, and converts the events into messages. Each message then invokes one or more rules which are executed by a rules engine. The execution of these rules may invoke the execution of additional rules. After all rules have executed, the account associated with the event is updated, such as by projecting the account. The rules have their parameters defined in a repository so that the parameters can be easily changed without any need to recompile. The processing systems receive authorizations and other transactions and runs in real-time as transactions arrive. As a result, balances are updated continuously and accounts are read and updated only when there is activity. Hierarchy is user configurable, including multiple hierarchy to any depth. System operations are controlled by rules and their parameters and most modifications can be accomplished without access to source code.

Owner:CORECARD SOFTWARE

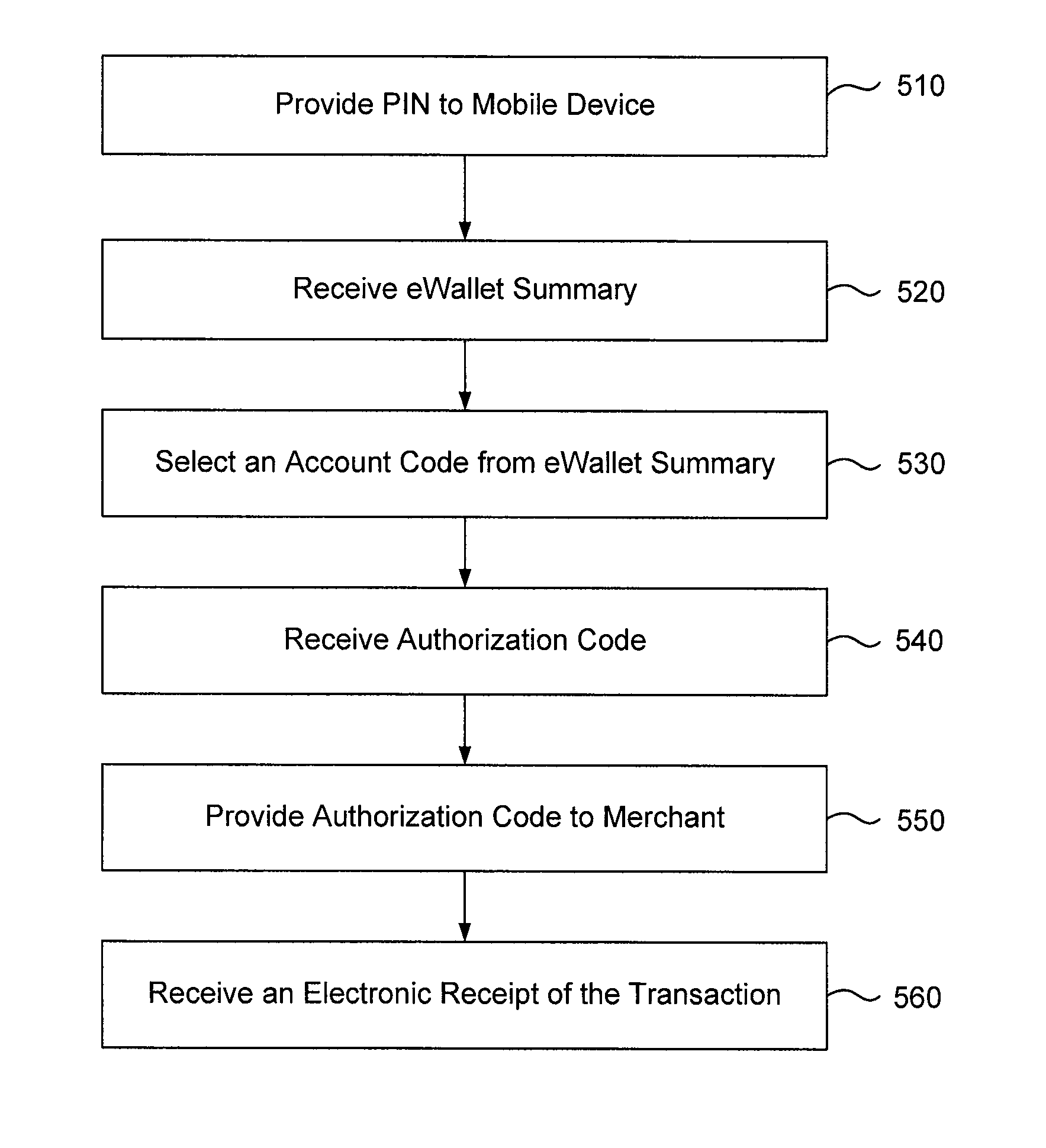

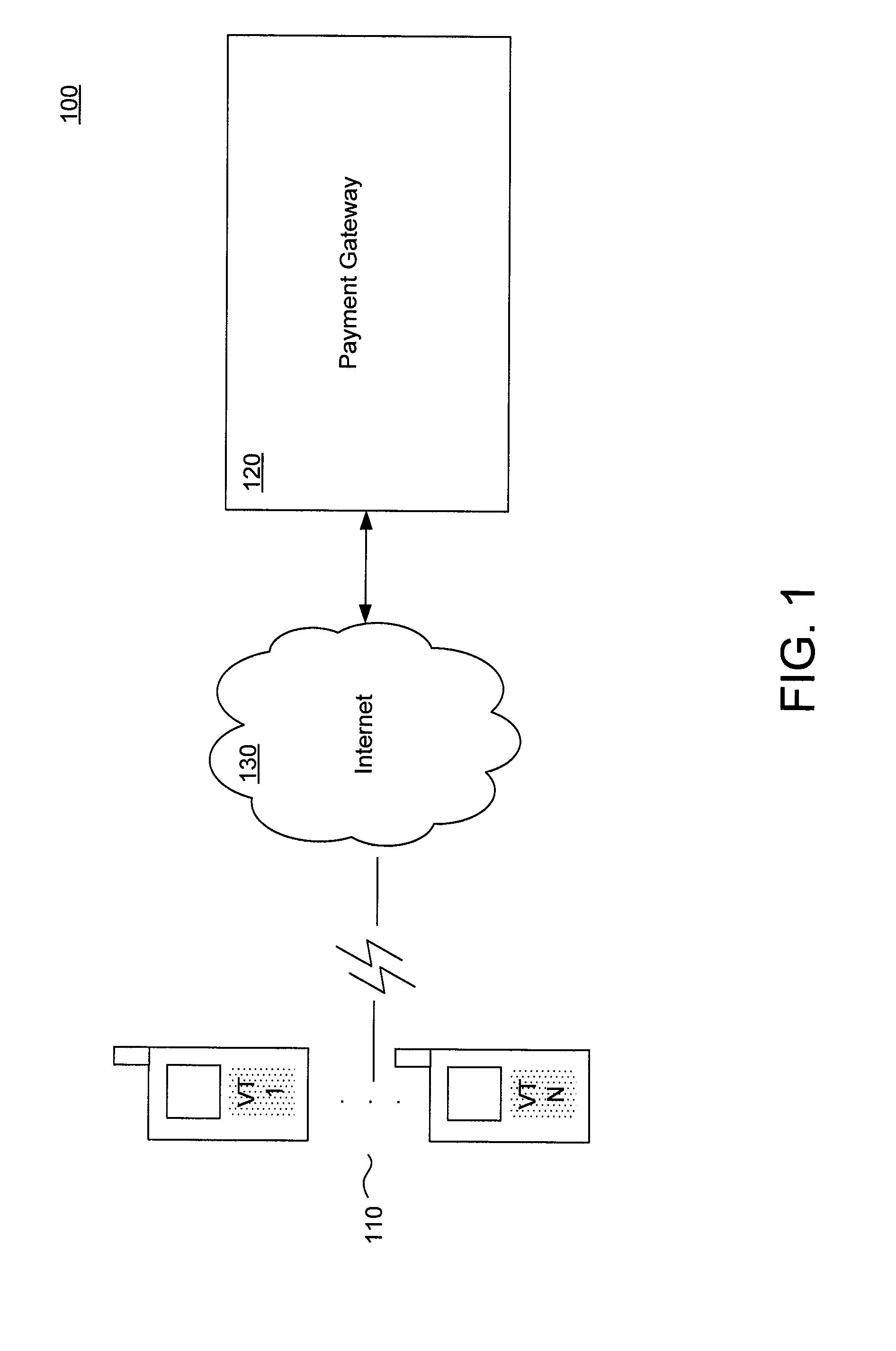

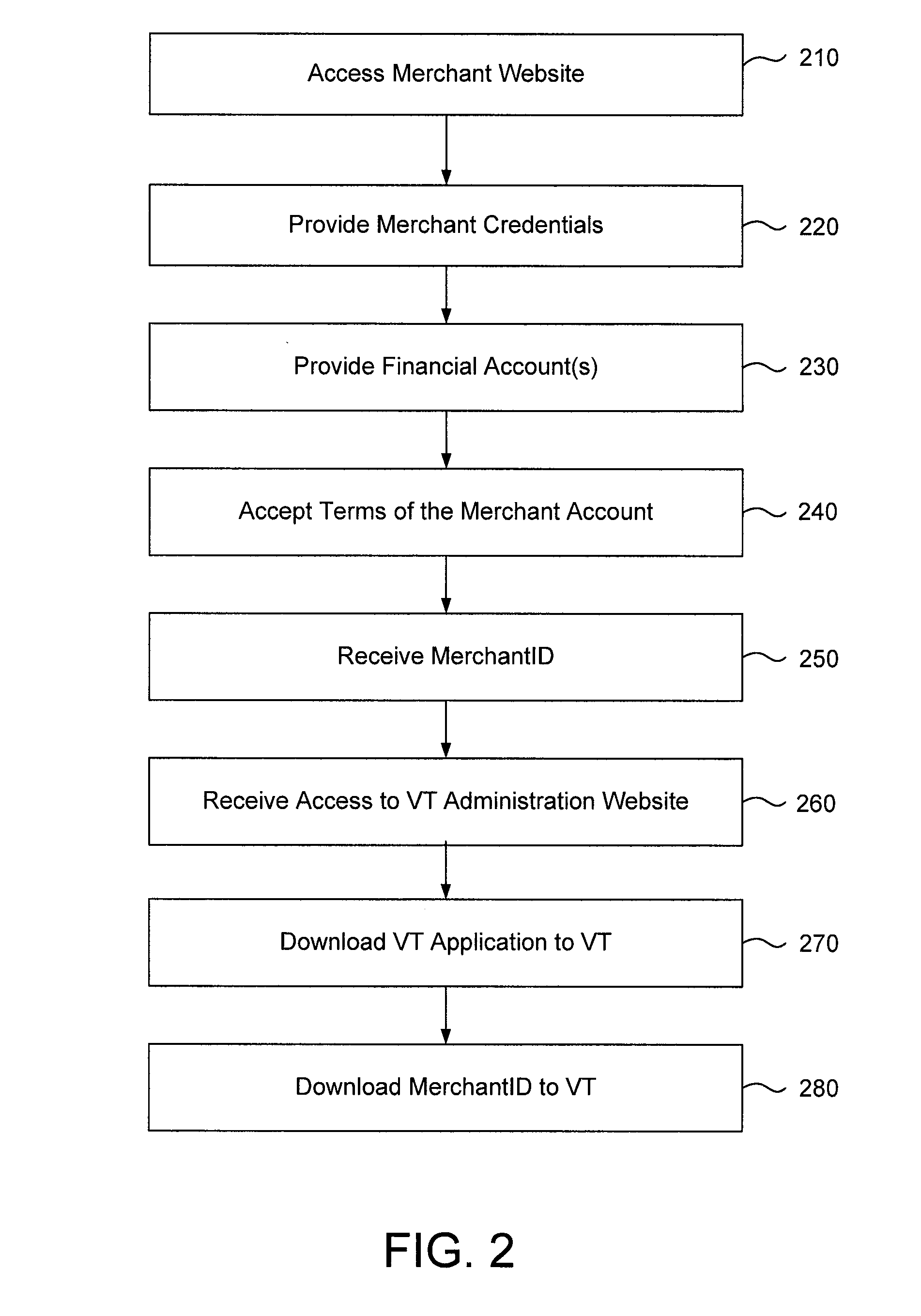

Method and System for Processing Secure Wireless Payment Transactions and for Providing a Virtual Terminal for Merchant Processing of Such Transactions

A system and method for processing a wireless electronic payment transaction is described. One embodiment comprises receiving a transaction authorization request for an electronic payment transaction from a customer, the authorization request submitted from a mobile communication device of the customer; authenticating the transaction authorization request; authorizing the transaction authorization request and transmitting an authorization code to the mobile communication device, the authorization code being communicated to a merchant from the customer; receiving a transaction approval request from the merchant, the transaction approval request submitted from a virtual terminal associated with the merchant, the virtual terminal being a wireless communication device having a point of sale processing application installed therein; authenticating the transaction approval request; approving the transaction approval request and transmitting an approval code to the virtual terminal; and generating and executing transaction settlement instructions between a financial account of the customer and a financial account of the merchant.

Owner:MOCAPAY

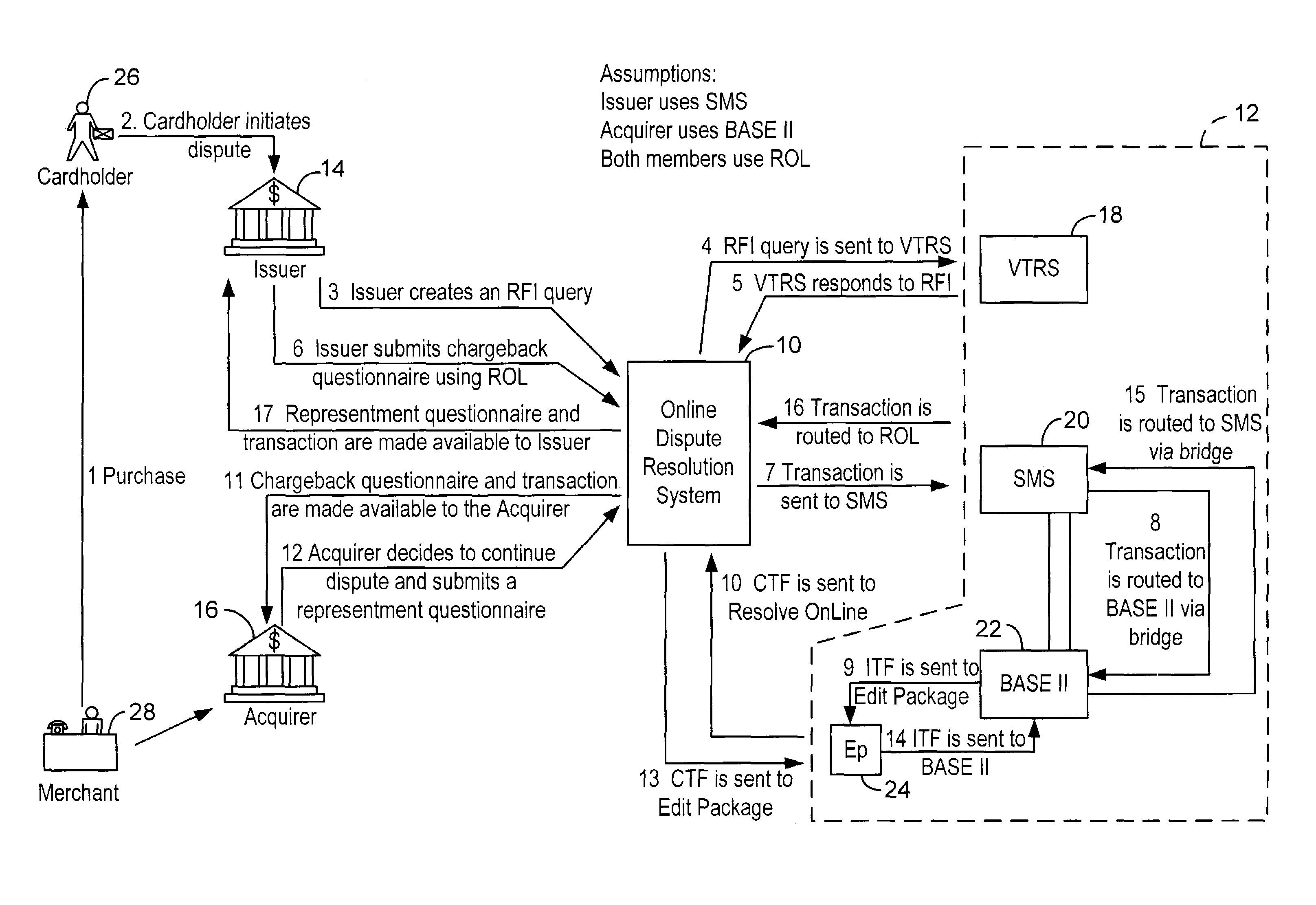

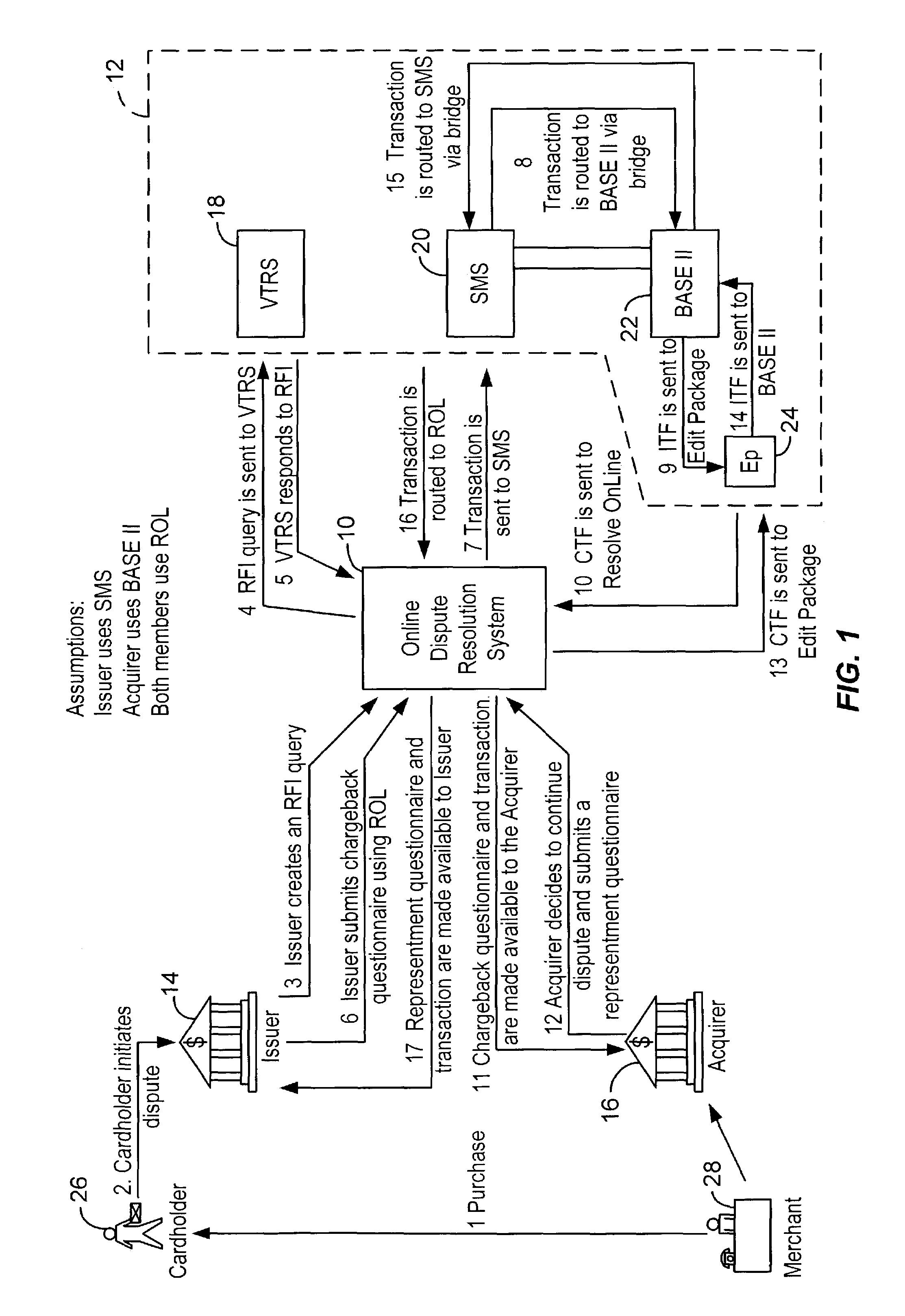

Method and system for facilitating electronic dispute resolution

A system for facilitating payment transaction disputes is provided. According to one aspect of the system, a user, such as an issuer, is allowed to use the system to resolve a disputed transaction. Based on information provided by a cardholder, the issuer is able to use the system to retrieve transactional information relating to the disputed transaction reported by the customer for review. When the issuer uses the system to retrieve information relating to the disputed transaction, a case folder is created. The case folder is a repository for storing all the relevant information and documentation relating to the disputed transaction. Using the information retrieved by the system, the issuer then determines whether to initiate a dispute. Alternatively, the system can also be used by an acquirer to respond to a dispute, usually on behalf of one of its merchant. If a dispute is responded to, a questionnaire is then created by the system. Alternatively, the issuer may decline to initiate a dispute and either seek additional information from the cardholder or deny the cardholder's inquiry. The case folder and the questionnaire are created for a specific disputed transaction. The questionnaire is designed to capture information from the cardholder and / or the issuer relating to the disputed transaction. The questionnaire may be pre-populated with previously retrieved transactional information which is stored in the case folder. Relevant documents in support of the disputed transaction may also be attached as part of the questionnaire. Various parties to the dispute may then provide relevant information (including supporting documentation) to the system. The relevant information provided by the parties is maintained in the case folder. The system then keeps track of the relevant timeframes for the case folder to ensure that each party to the dispute is given the correct period of time to respond during the processing of a dispute. Prior to filing the dispute for arbitration or compliance, the system permits the parties to resolve the dispute amongst themselves without the help of an arbiter through pre-arbitration and pre-compliance. If the parties to the dispute are unable to resolve the dispute on their own, the system also permits the parties to resolve the dispute via arbitration or compliance with the help of an arbiter. The system provides the arbiter with access to the case folder to allow the arbiter to render an informed decision on the dispute.

Owner:VISA USA INC (US)

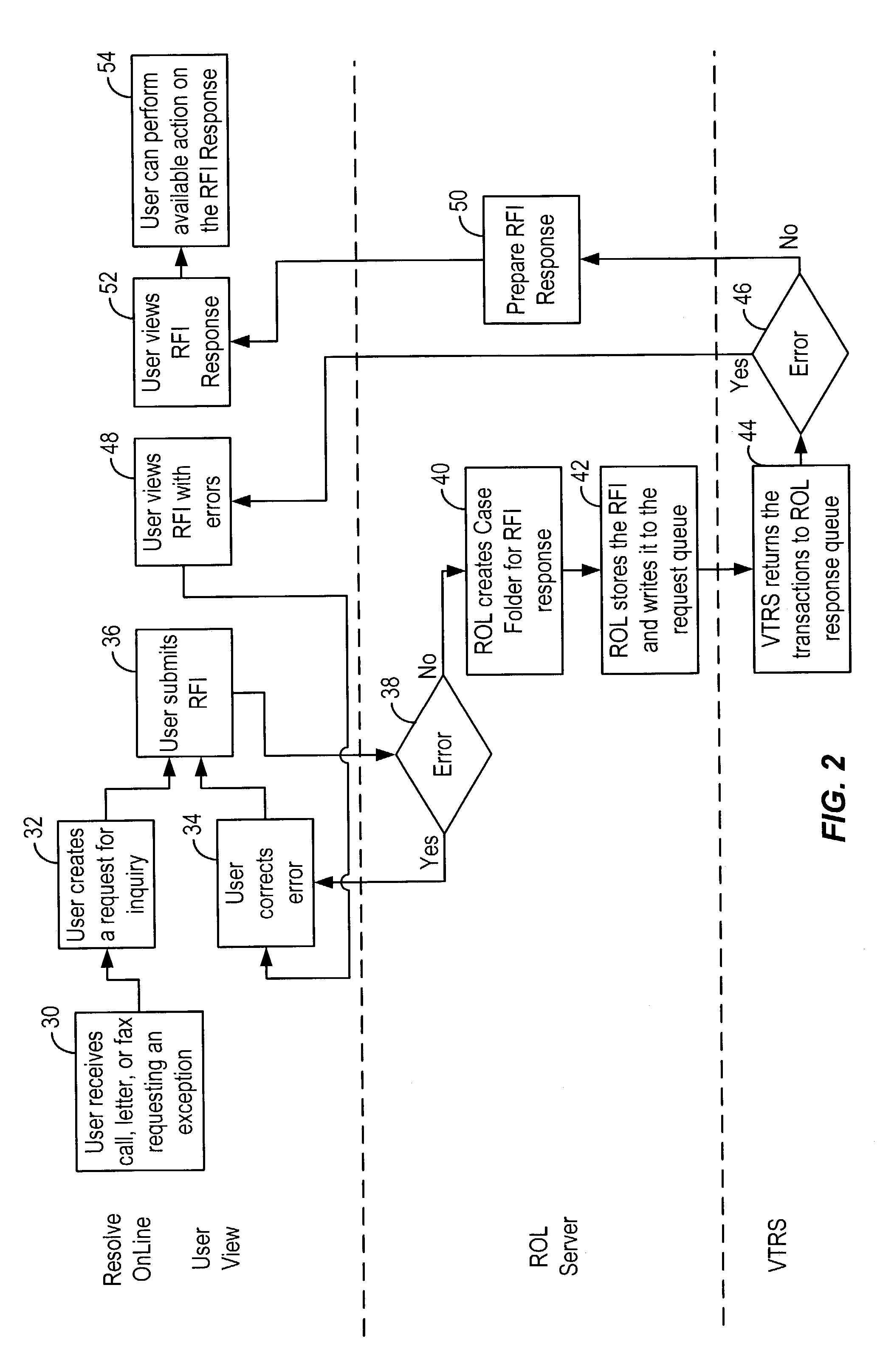

System and Method for Issuing and Using a Loyalty Point Advance

InactiveUS20090106112A1Convenient transactionComplete banking machinesFinanceLoyalty programComputer science

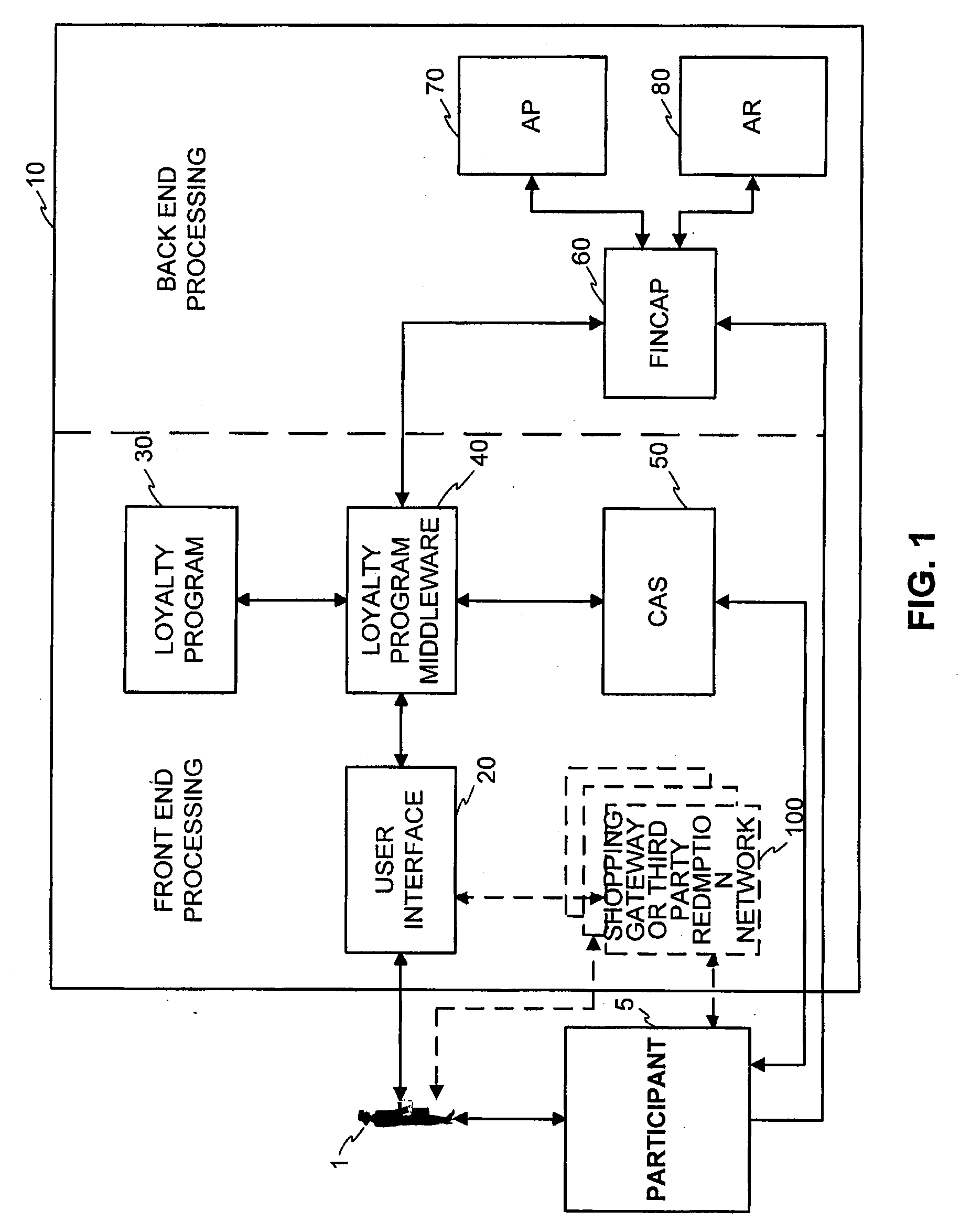

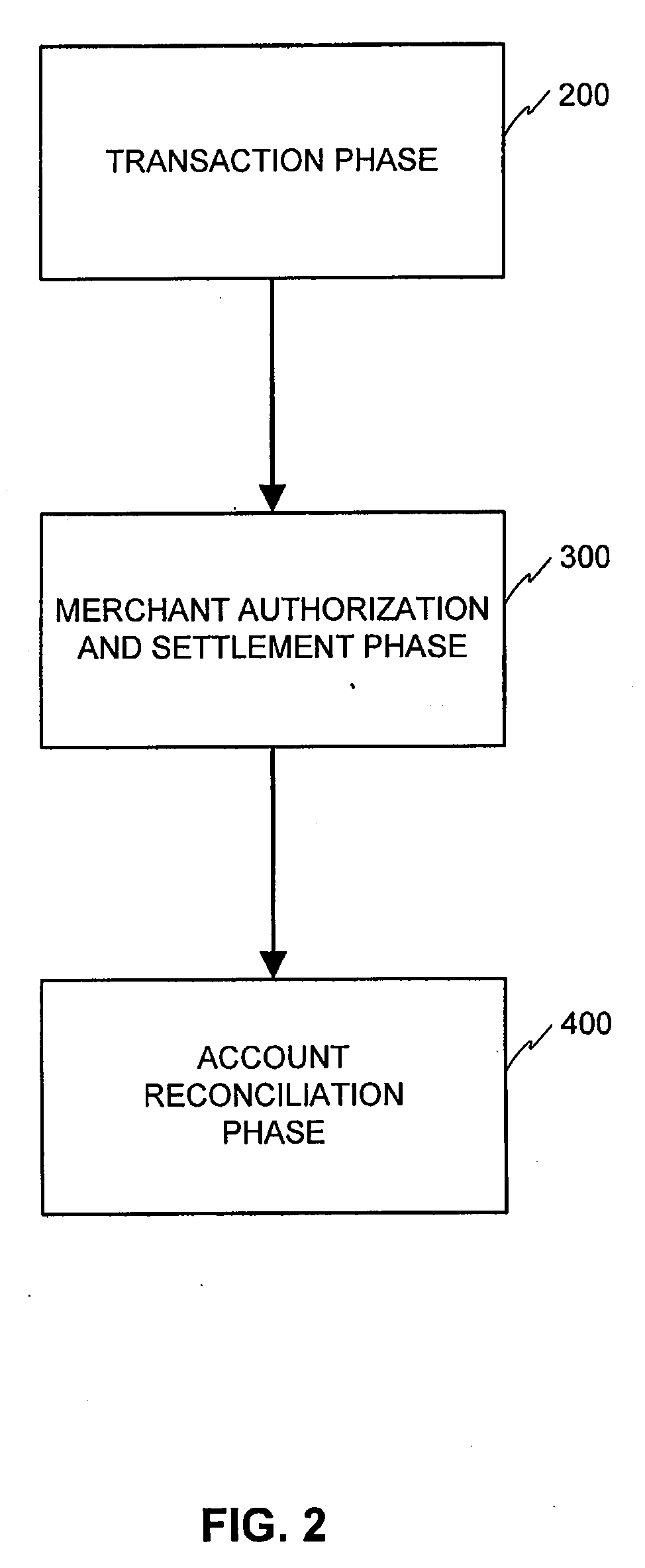

A system and method for spending loyalty points over a computerized network to facilitate a loyalty point transaction is disclosed. The system enables a participant of a loyalty program to accept an advance of loyalty point when a loyalty account balance is insufficient to make a desired purchase. An amount of loyalty points available as an advance to a participant is determined based on a number of criteria related to the participant, financial account activity, and loyalty account activity. The participant is allotted a predetermined length of time to earn or purchase enough loyalty points to repay the balance of advanced loyalty points. If, at the conclusion of such predetermined length of time, sufficient points have not been earned to offset the loyalty point advance, the participant is charged the currency value of each outstanding loyalty point. The participant may be assessed interest charges and / or fees at the time of the loyalty point advance, during reimbursement, or at the end of a time period for reimbursement.

Owner:LIBERTY PEAK VENTURES LLC

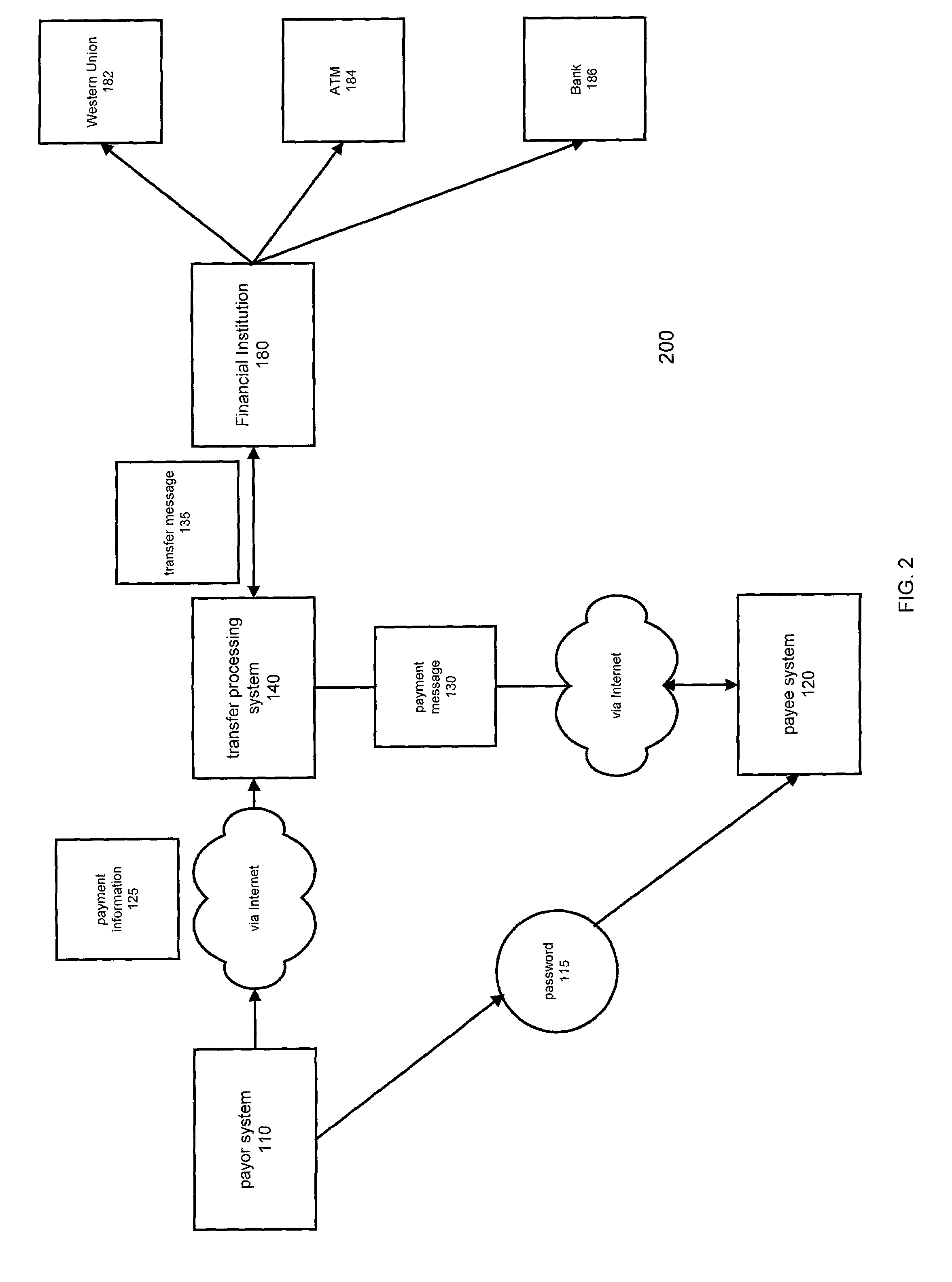

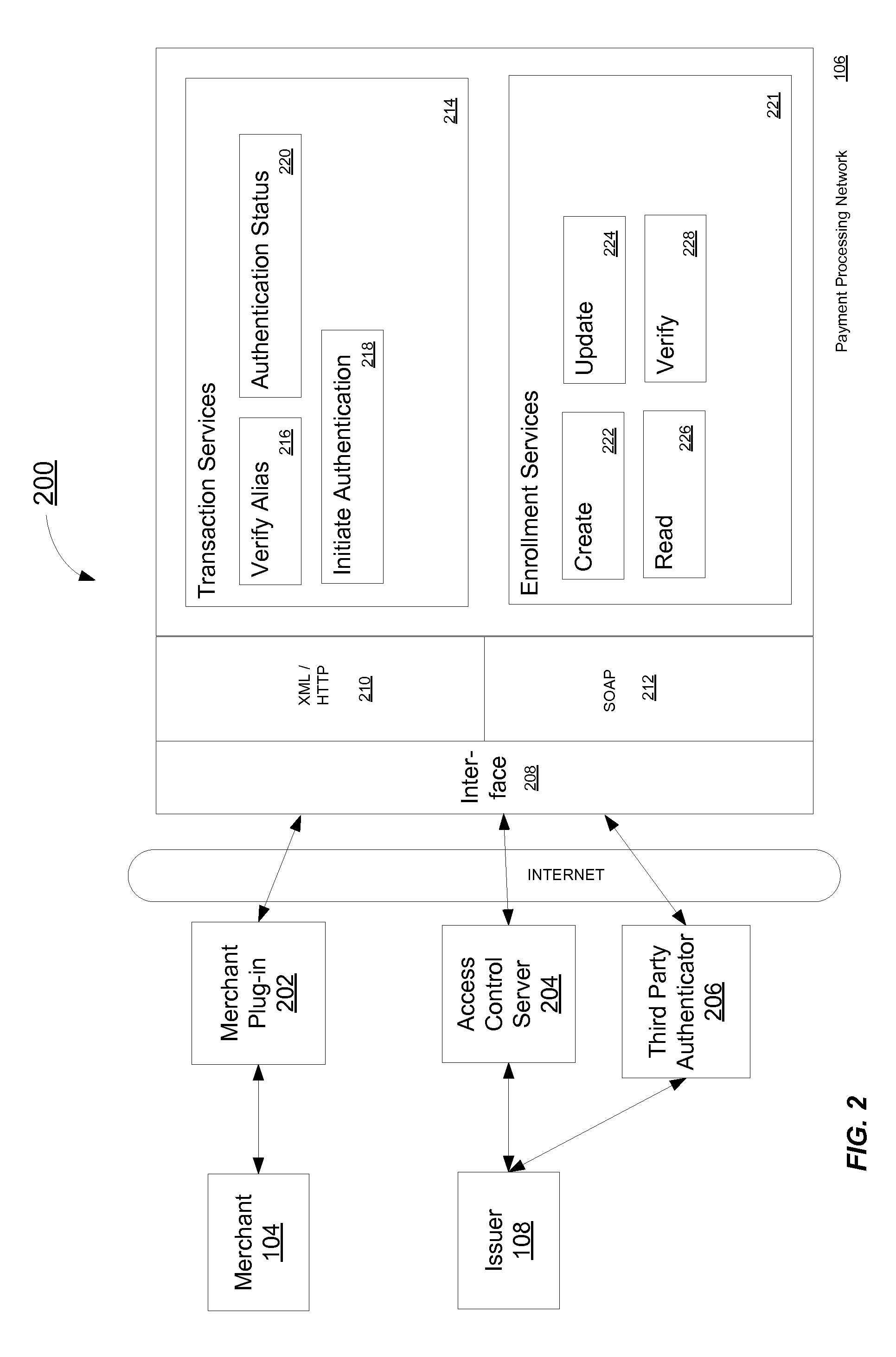

Mobile account authentication service

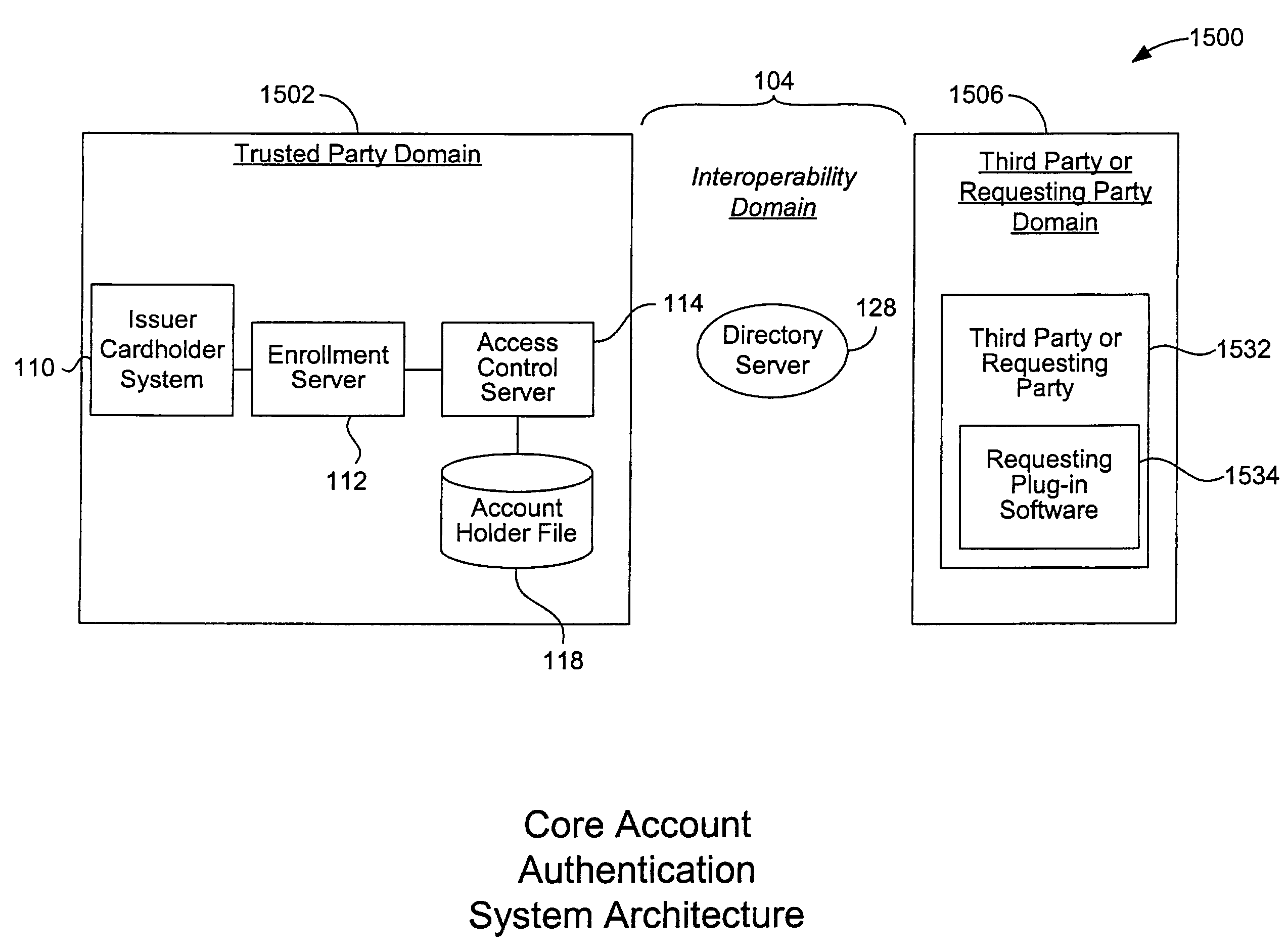

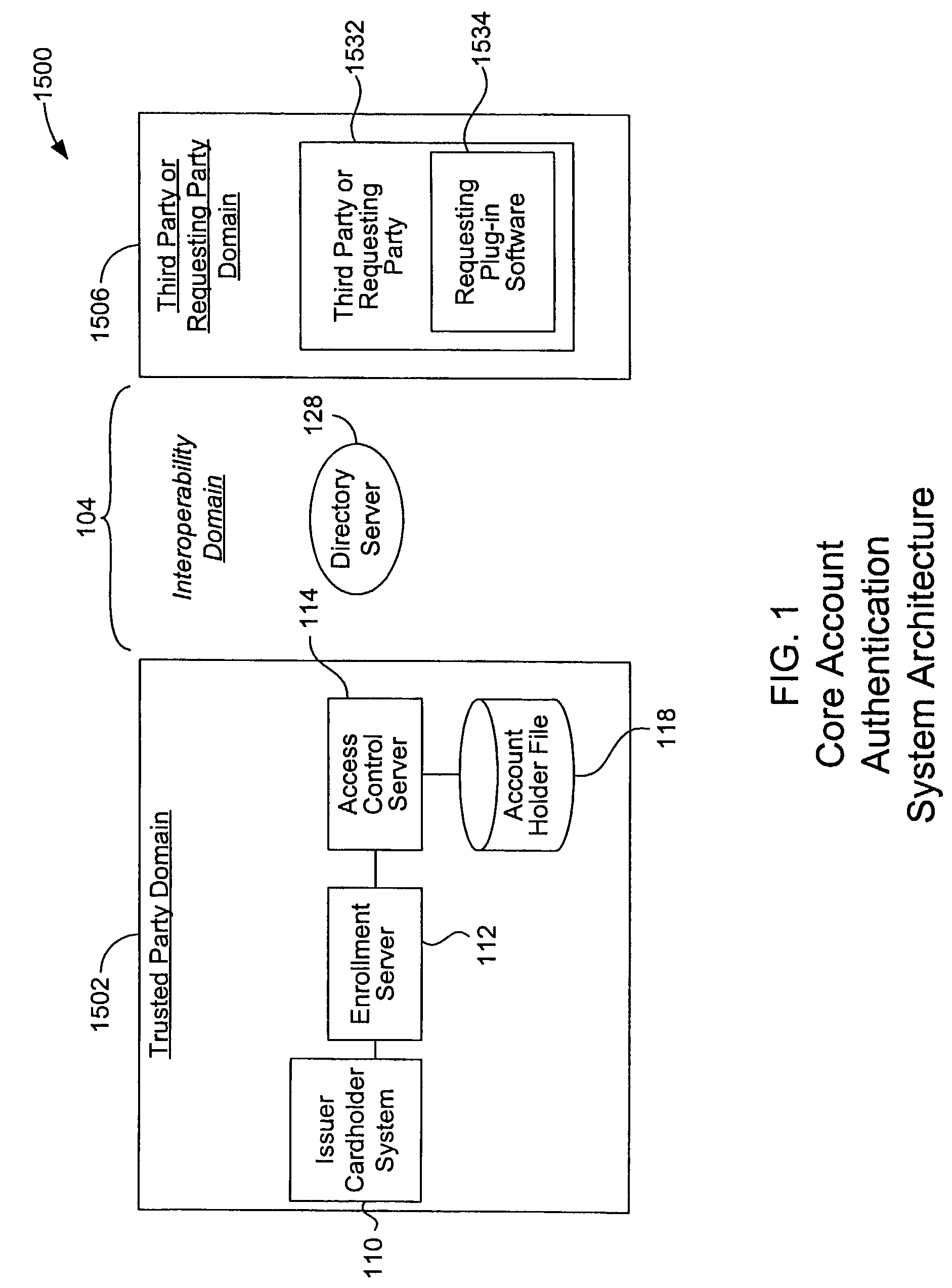

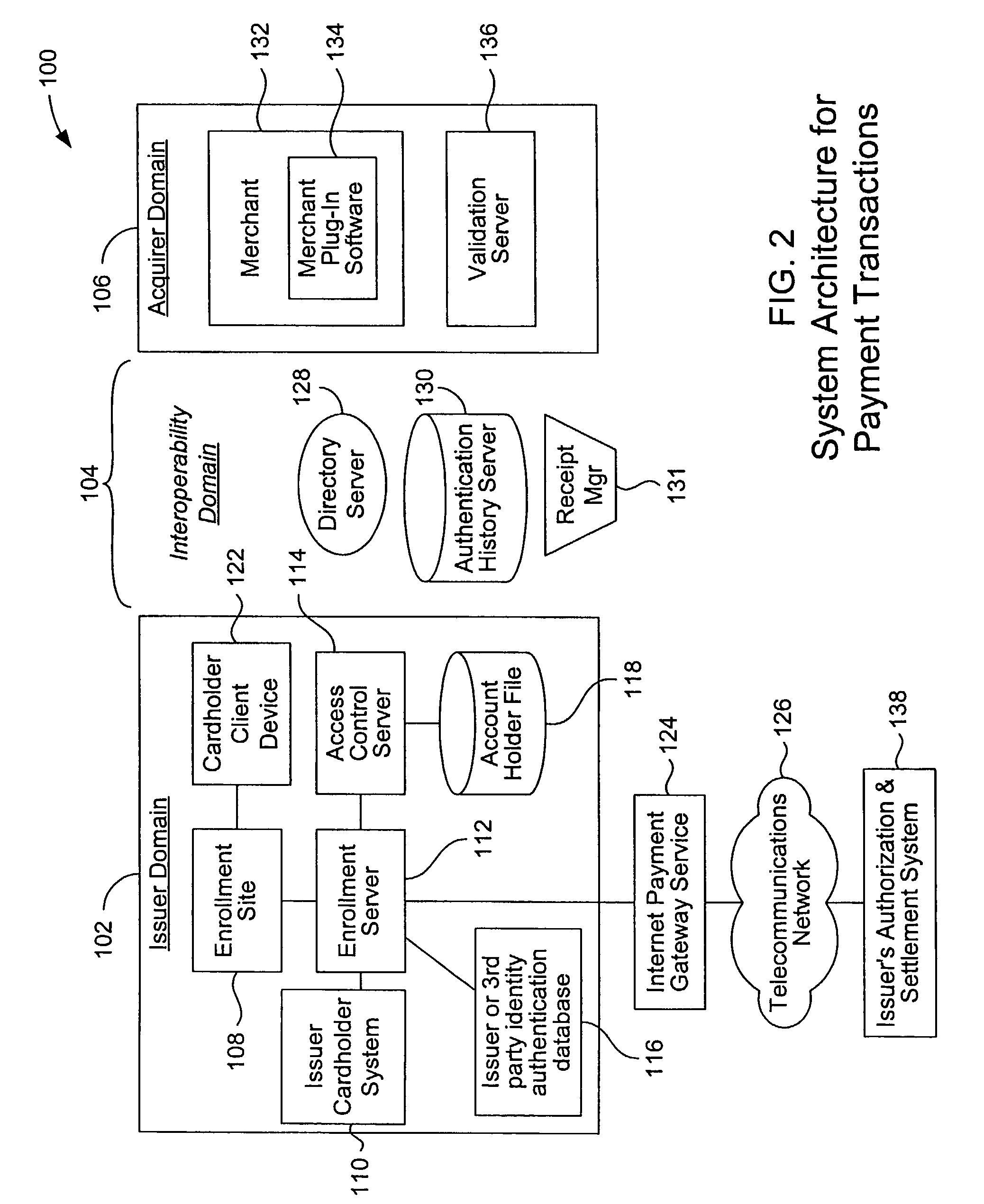

ActiveUS7707120B2Minimal investmentHigh level of interoperabilityComplete banking machinesFinanceInternet Authentication ServicePayment

A payment authentication service authenticates the identity of a payer during online transactions. The authentication service allows a card issuer to verify a cardholder's identity using a variety of authentication methods, such as with the use of tokens. Authenticating the identity of a cardholder during an online transaction involves querying an access control server to determine if a cardholder is enrolled in the payment authentication service, requesting a password from the cardholder, verifying the password, and notifying a merchant whether the cardholder's authenticity has been verified. Systems for implementing the authentication service in which a cardholder uses a mobile device capable of transmitting messages via the Internet are described. Systems for implementing the authentication service in which a cardholder uses a mobile device capable of transmitting messages through voice and messaging channels is also described.

Owner:VISA INT SERVICE ASSOC

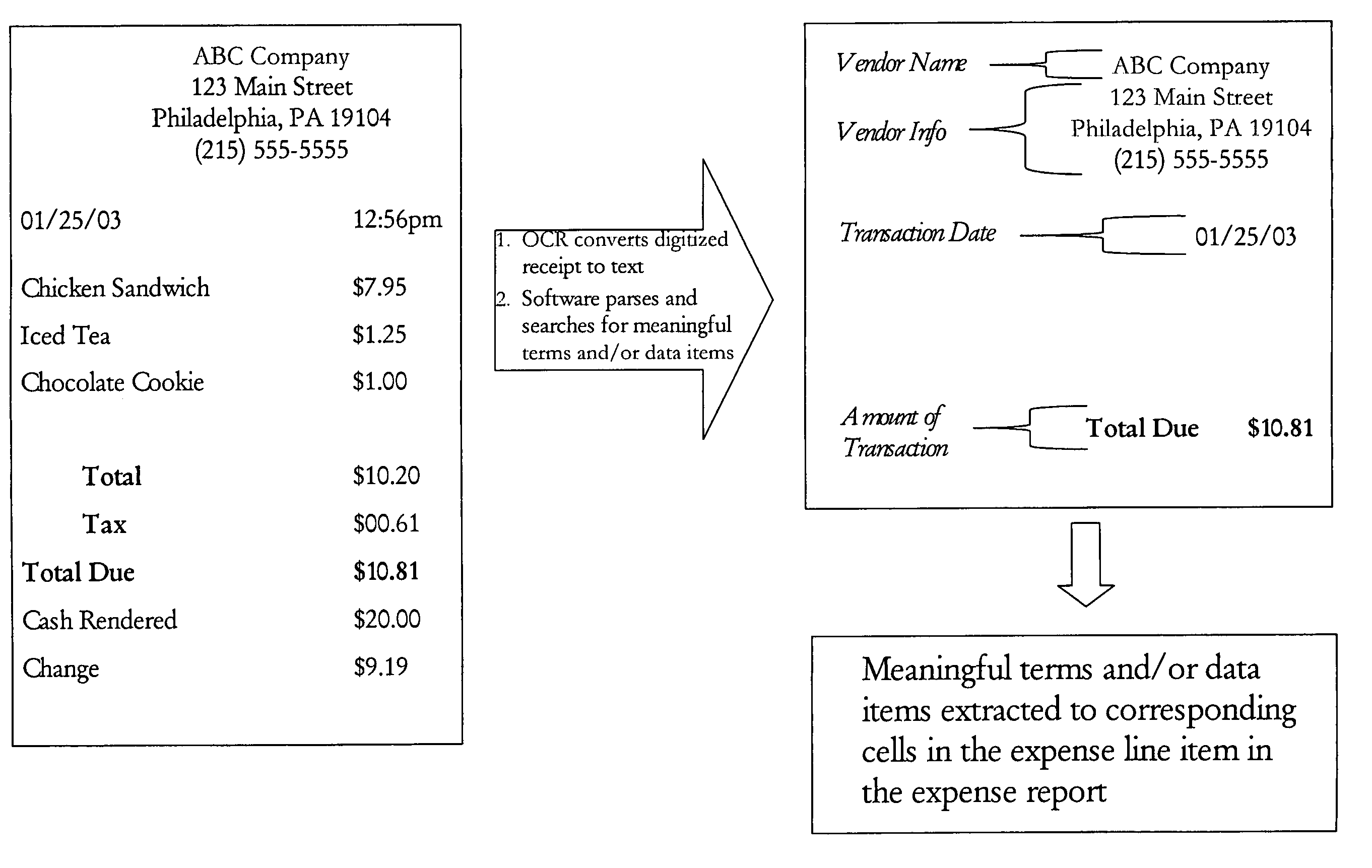

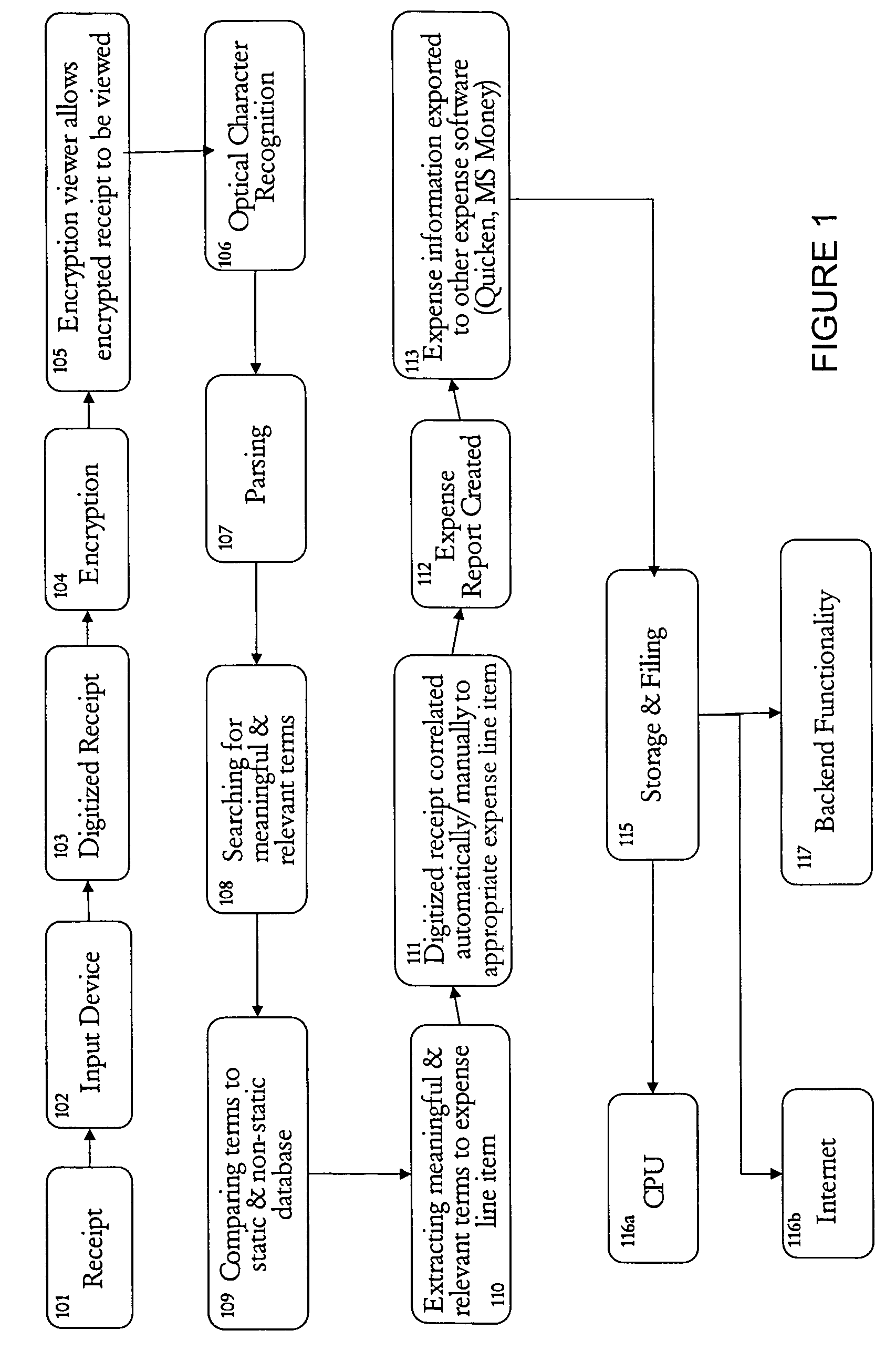

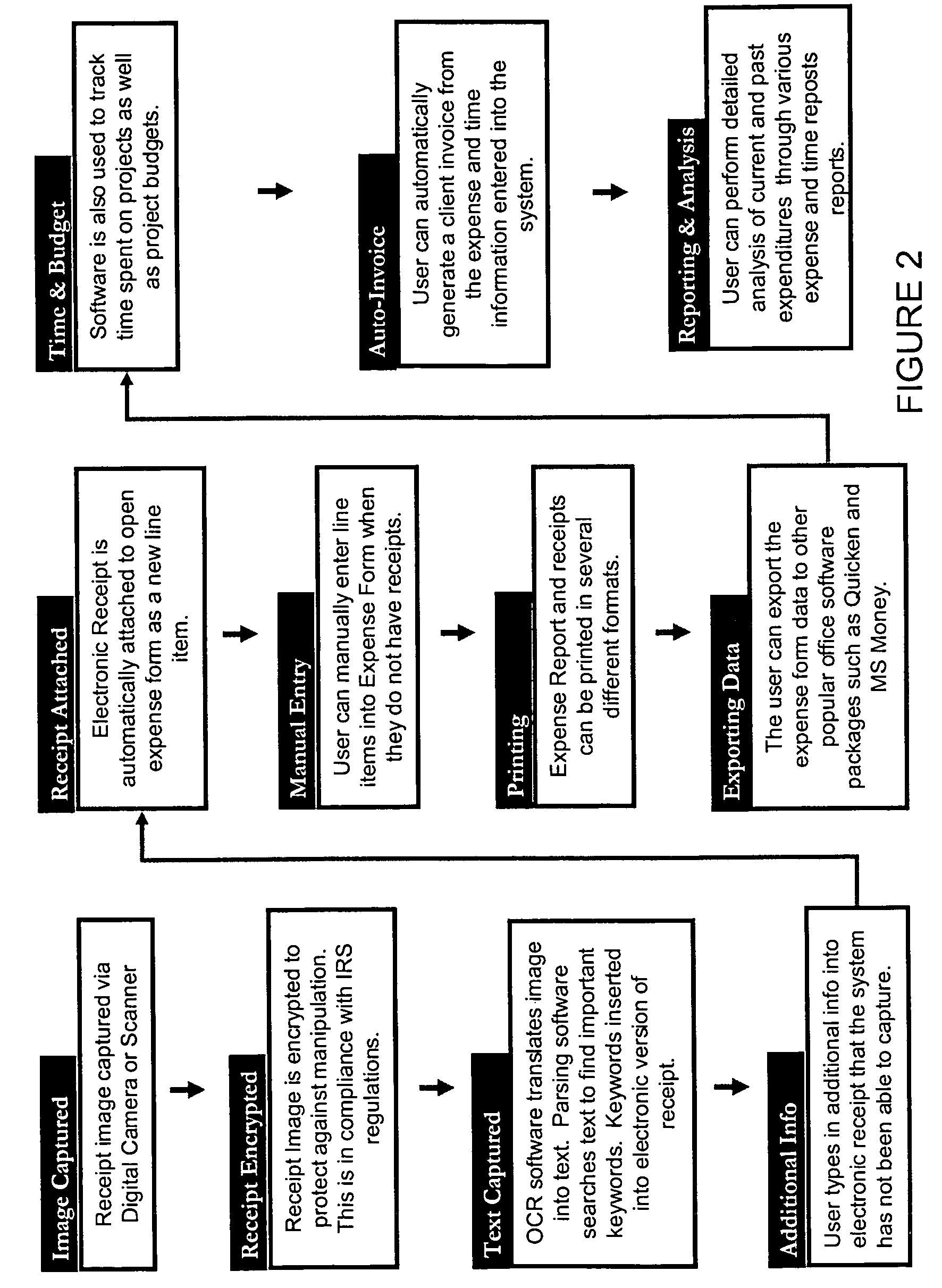

System and method for capture, storage and processing of receipts and related data

ActiveUS7069240B2Easy to editConvenient reviewComplete banking machinesFinanceThird partyComputer graphics (images)

The present invention is a system comprising image capture device, such as a scanner or digital camera connected to a computer processor that is able to capture and store images, and method of using the same for storing and processing expense receipts. The computer processor analyzes the images of the receipts, converts the images to text, analyzes the data, extracts expense data, and puts the data into an expense report. The end user can review the captured expense data, correct it or add to it. Preferably, the system displays the image of the receipt side-by-side with the captured expense data to make review and editing easier. In a preferred embodiment the image capture device is portable, such as a handheld scanner or digital camera, so that a user can scan receipts while traveling and discard the receipt. Also, in a preferred embodiment, the images are encrypted to prevent tampering by the user or a third party, and thereby preserve the integrity of the receipt image. In one preferred embodiment, receipt images or uploaded via the Internet an intranet, or other network to a remote data storage facility to further protect the images, both from tampering and from loss.

Owner:THE NEAT COMPANY INC DOING BUSINESS AS NEATRECEIPTS

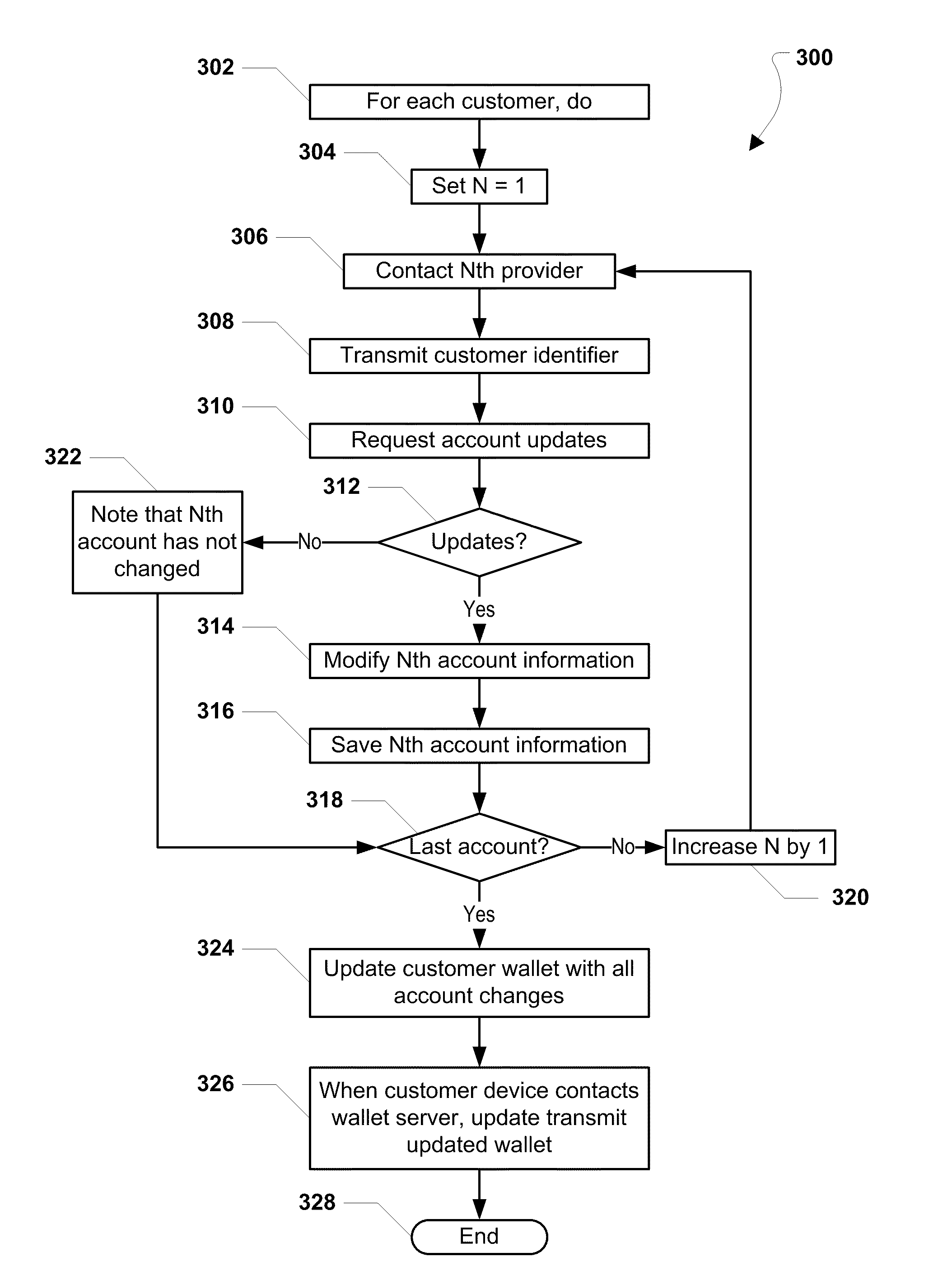

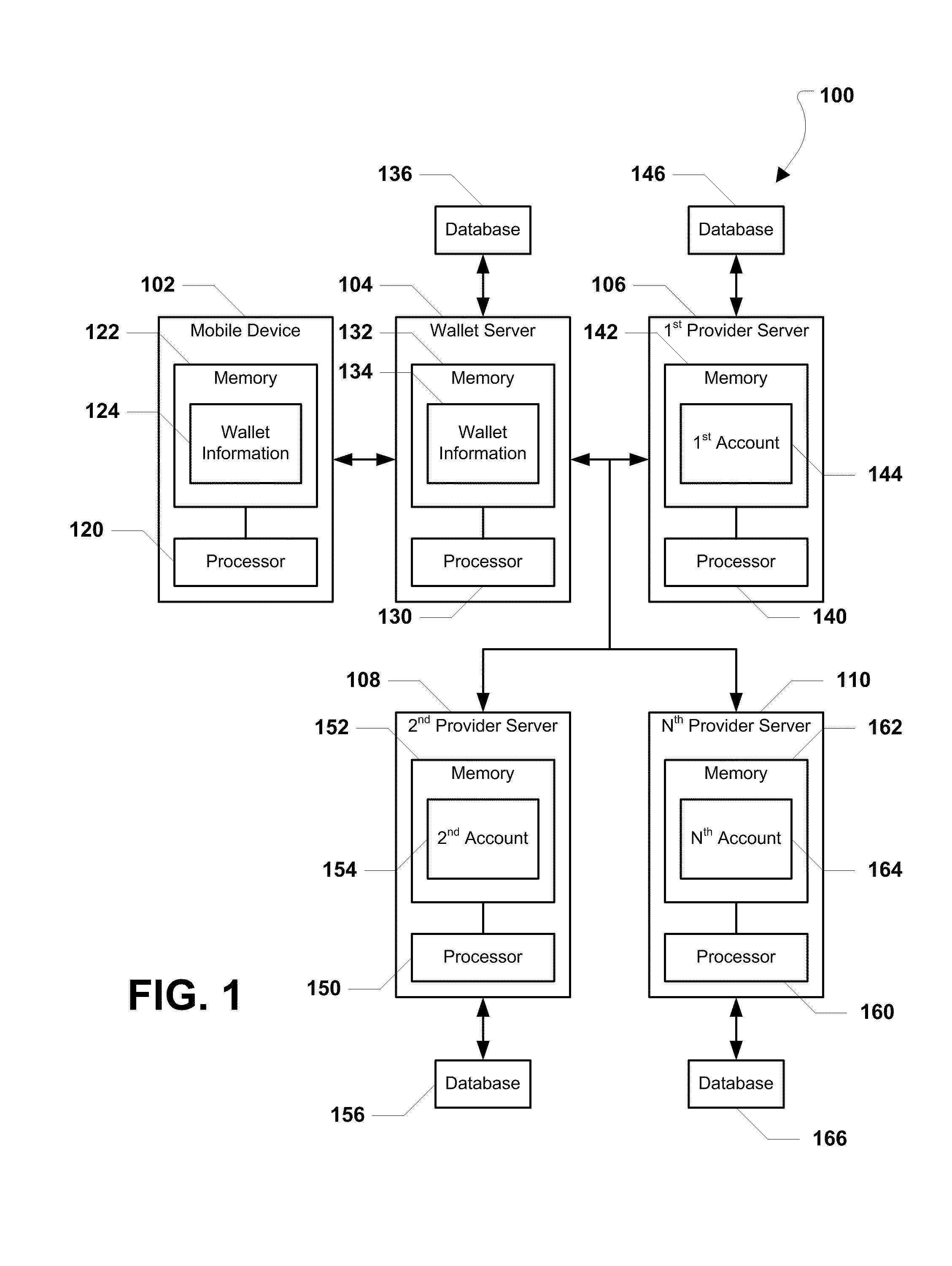

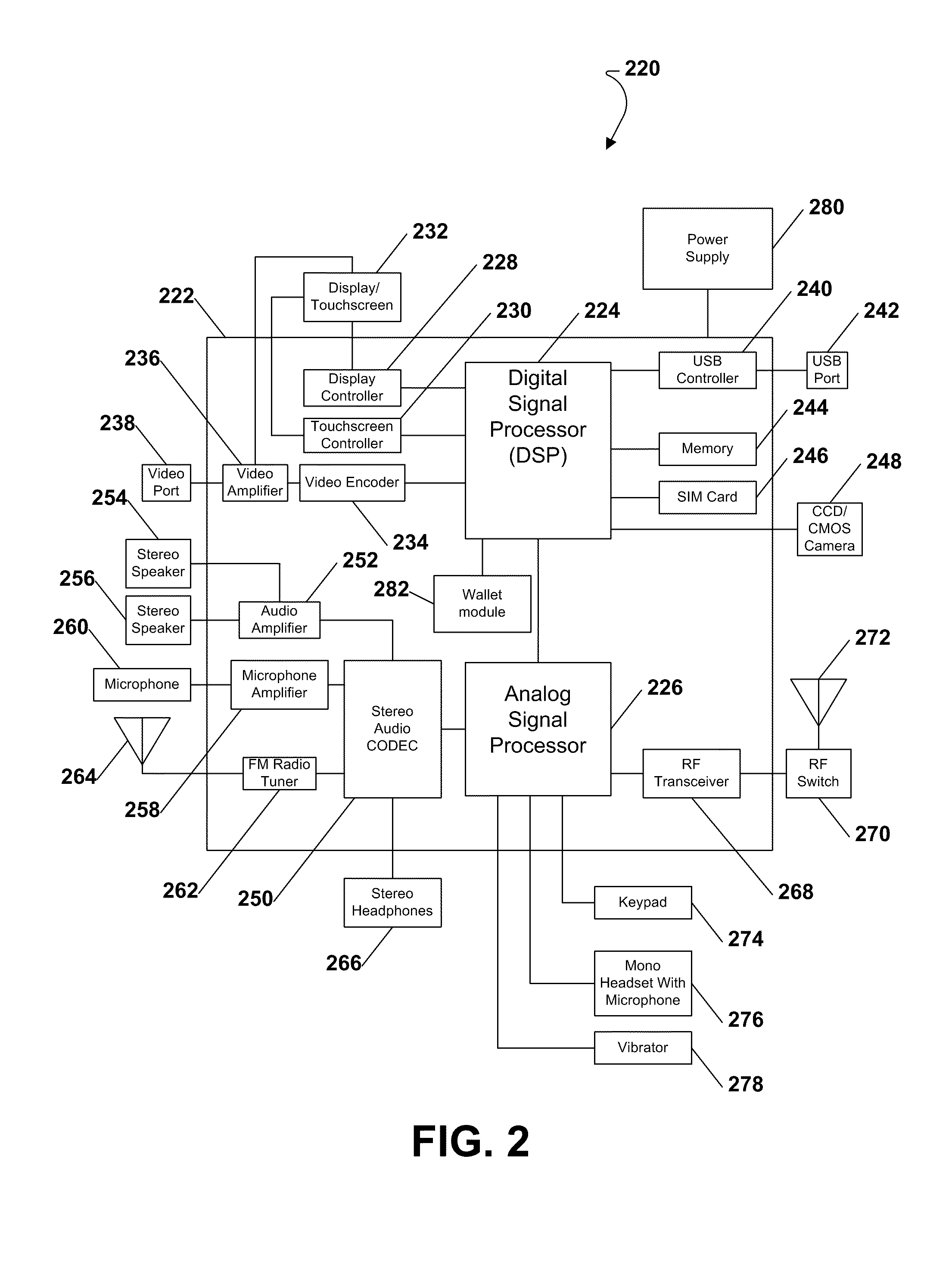

System and method of providing a mobile wallet at a mobile telephone

A method of providing a mobile wallet is disclosed and may include displaying a mobile wallet login screen and displaying a mobile wallet. The mobile wallet includes at least one of the following: an accounts option, a buy now option, an offers option, a receipts option, and a more option. The method further includes displaying one or more accounts when the accounts option is selected. The one or more accounts may include at least one of the following: a bank account, a credit account, a gift card account, and a rewards account.

Owner:QUALCOMM INC

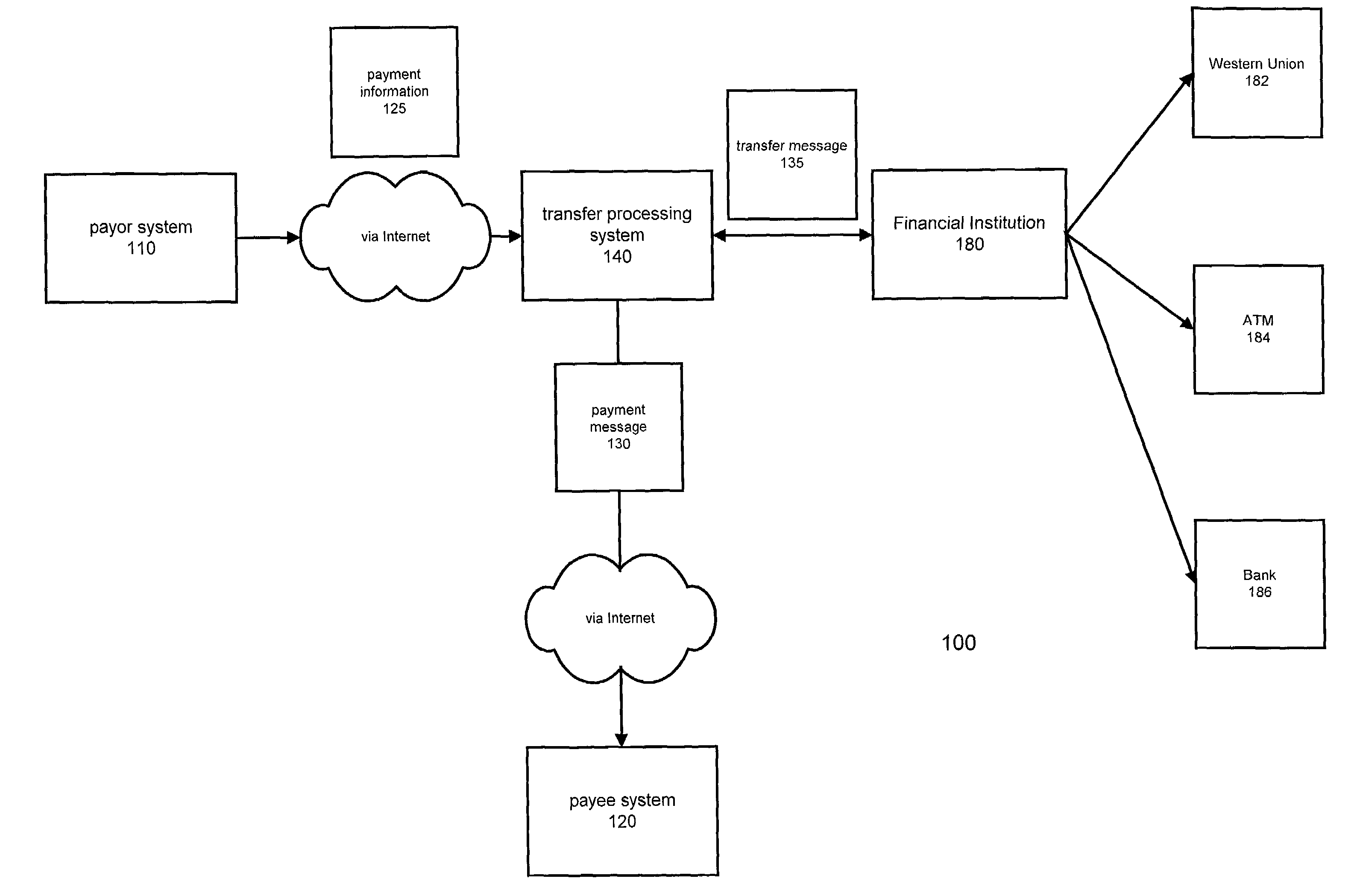

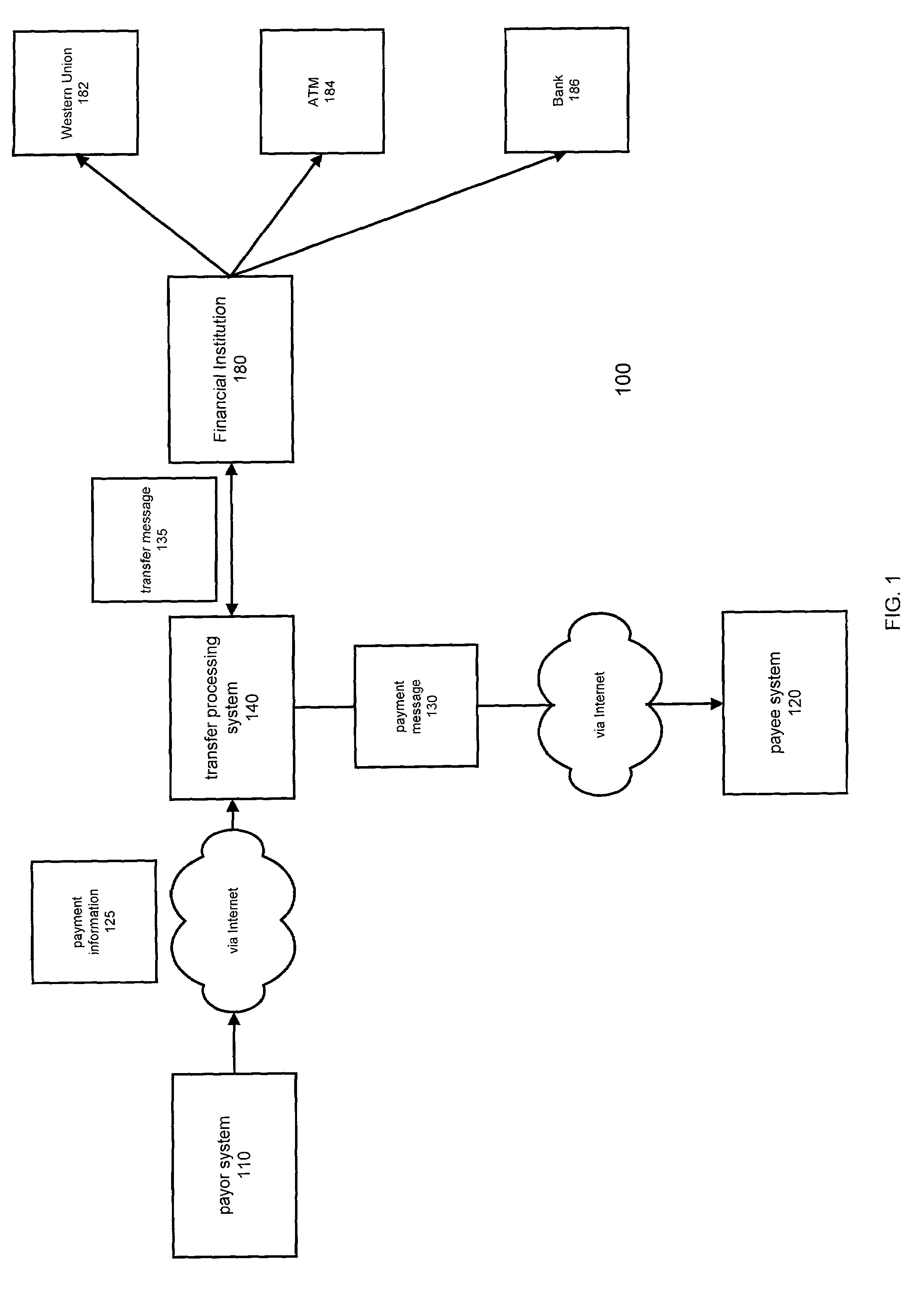

Method and system for transferring electronic funds

InactiveUS7644037B1Promote commercial linkQuick applicationComplete banking machinesFinanceCredit cardThe Internet

A method and system for transferring electronic funds over the Internet wherein a sender provides payment information to a transfer processing system. The sender may choose from a plurality of different types of funds transfer, such as wire transfer, Western Union money transfer, various types of checks, and transfers to ATM debit / credit cards. The transfer processing system sends an electronic payment message to a recipient indicating the transfer of funds and a transfer message to a financial institution providing instructions to debit the sender's account and make those funds available to the recipient. If the recipient has an account with a financial institution that is affiliated with the transfer processing system of the present invention, the funds are credited to the recipient's account wherein the payment message serves as a confirmation message. If the recipient does not have such an account, the recipient may access the transfer processing system to access the funds made available by the system wherein the payment message serves as a payment availability message.

Owner:BLACKBIRD TECH

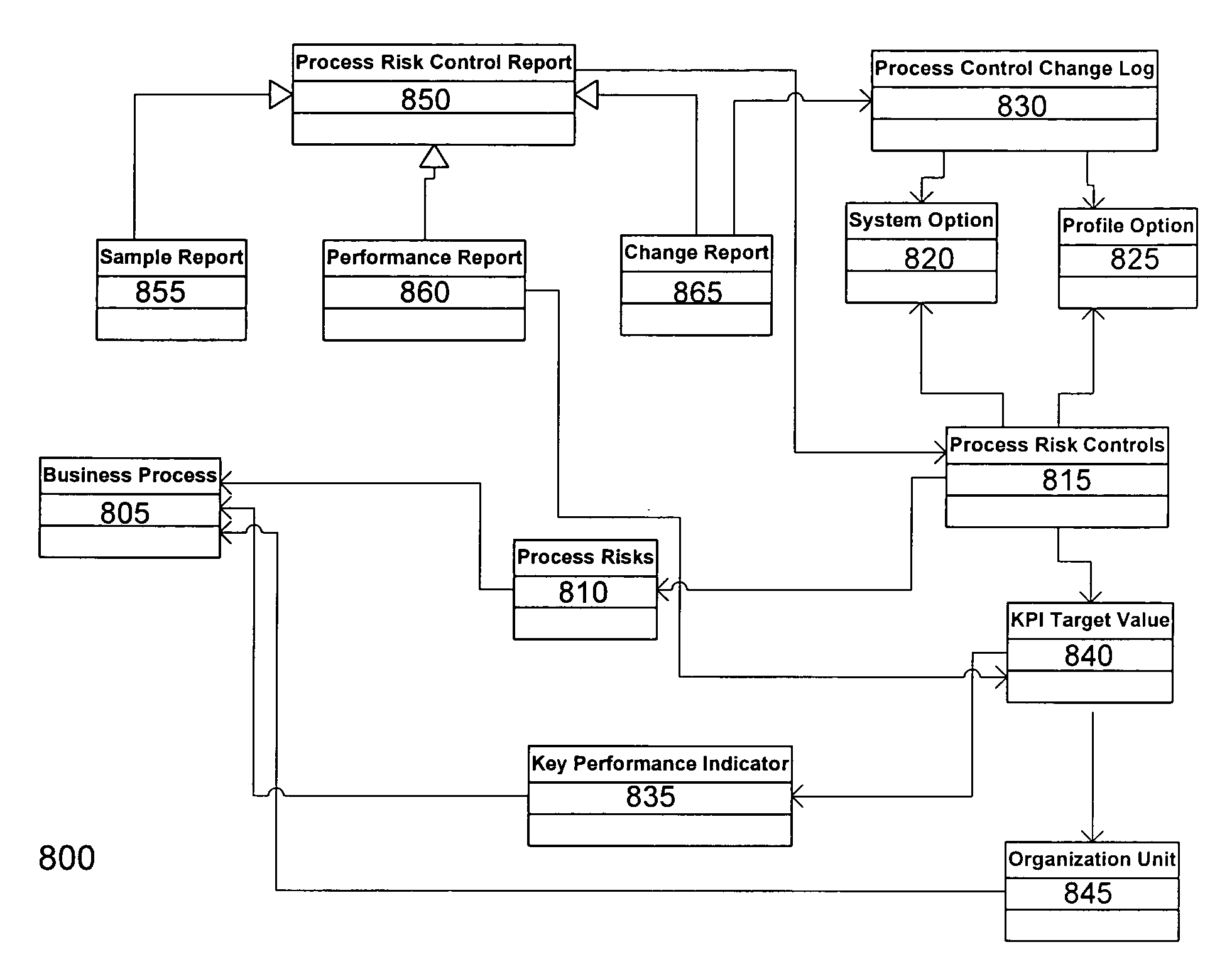

Internal audit operations for Sarbanes Oxley compliance

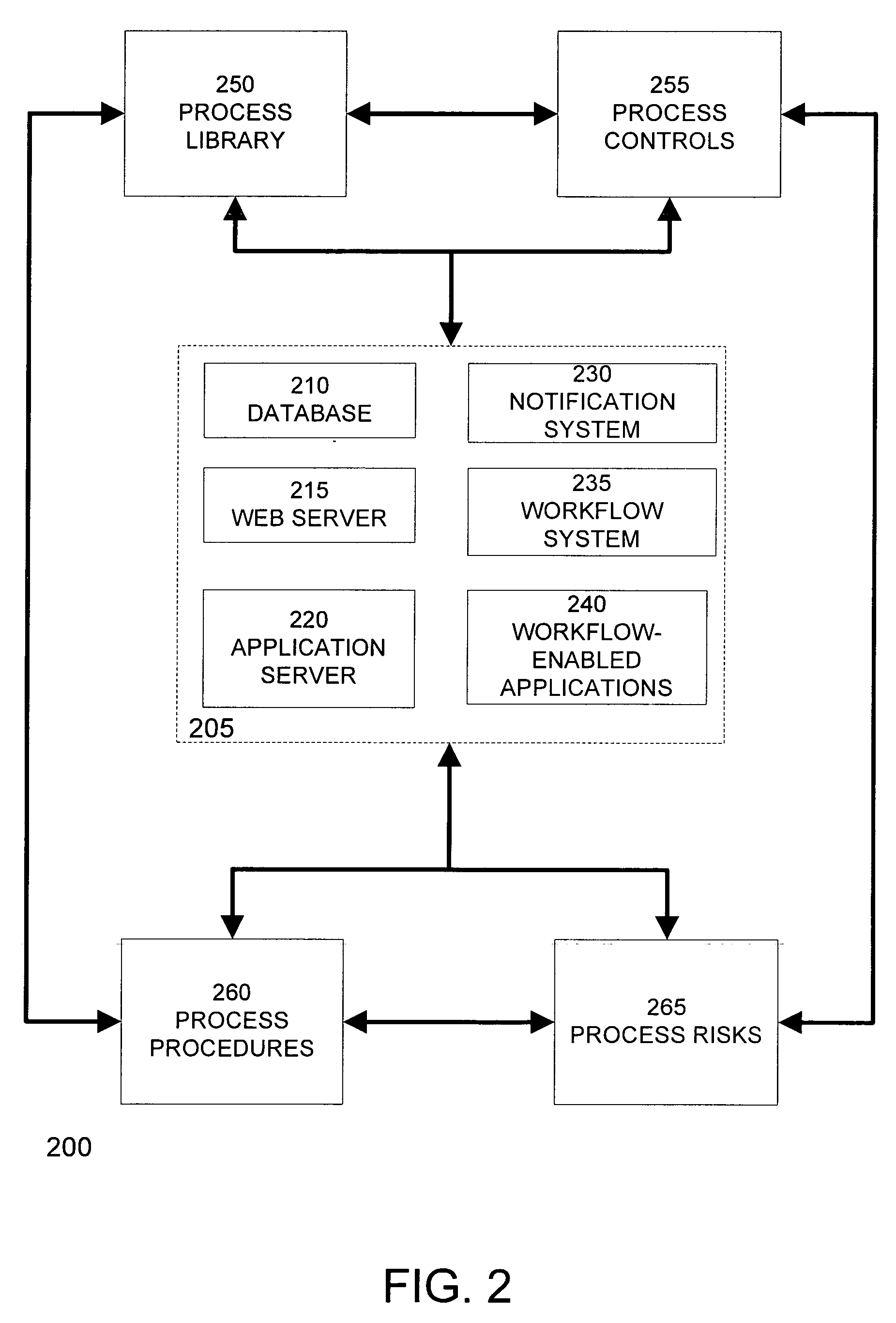

A system provides audit opinions on an enterprise's organizations, processes, risks, and risk controls. The system first evaluates the enterprise's set of risk controls. The audit opinions of the set of risk controls are used to evaluate the set of risks associated with the set of risk controls. The audit opinions of the set of risks and of the set of risk controls are in turn used to evaluate the set of processes associated with the set of risks. Finally, all of these audit opinions are used to evaluate the set of organizations associated with the set of processes. The system streamlines the evaluation of risk by determining suggested audit opinions. Suggested audit opinions for a given item can be determined from audit opinions previously determined and associated with the given item. Rules can be defined for a given item to specify how to determine the suggested audit result.

Owner:ORACLE INT CORP

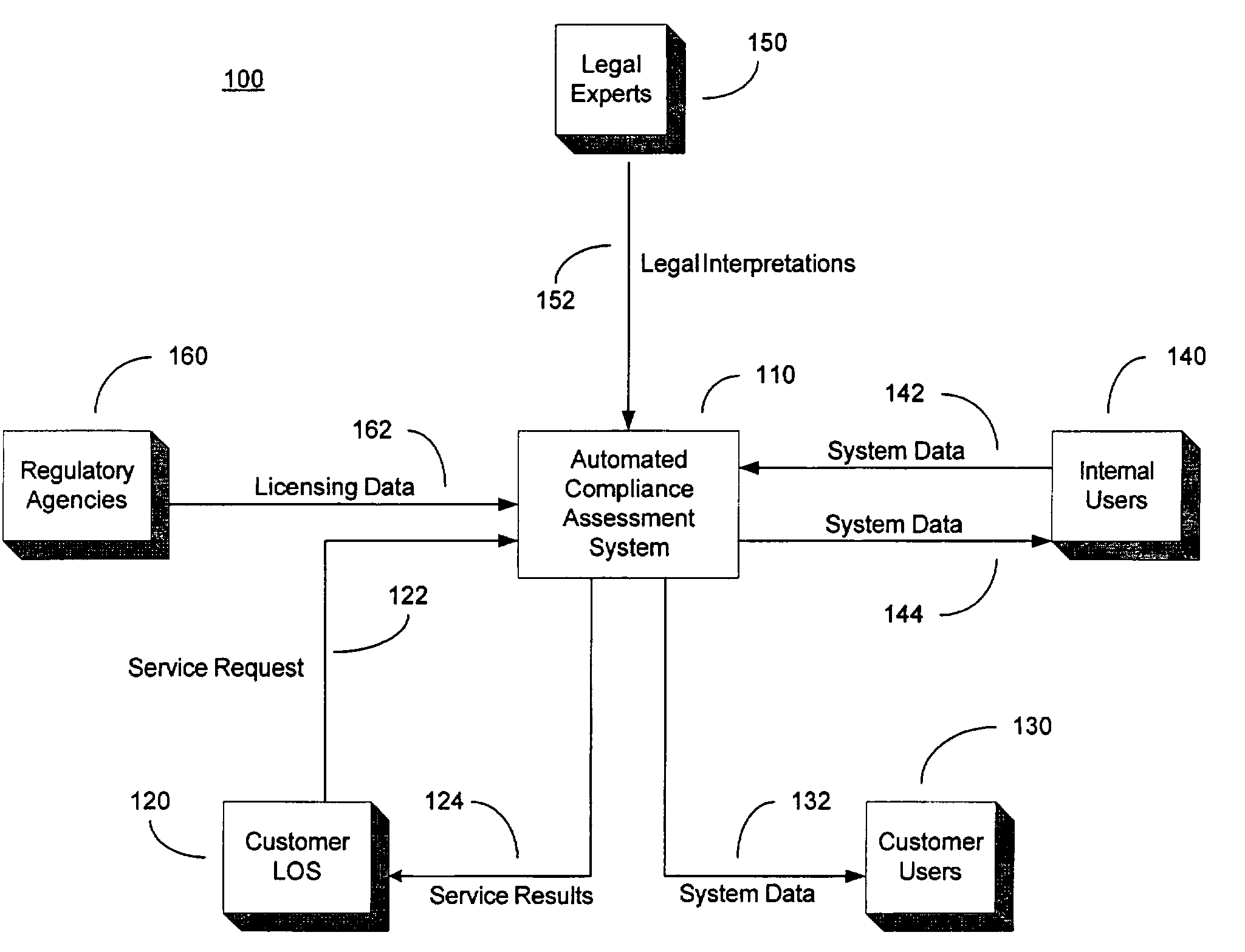

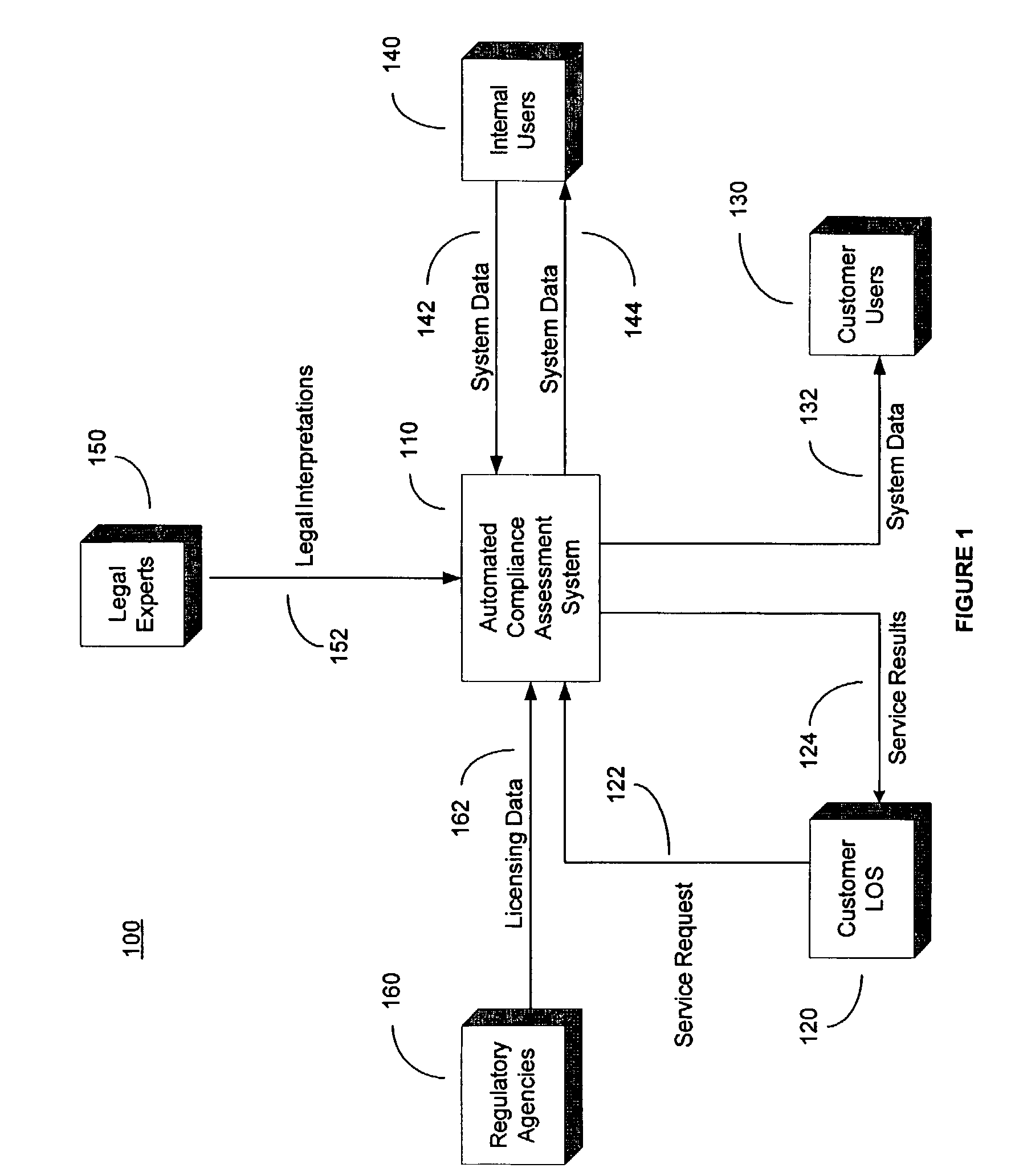

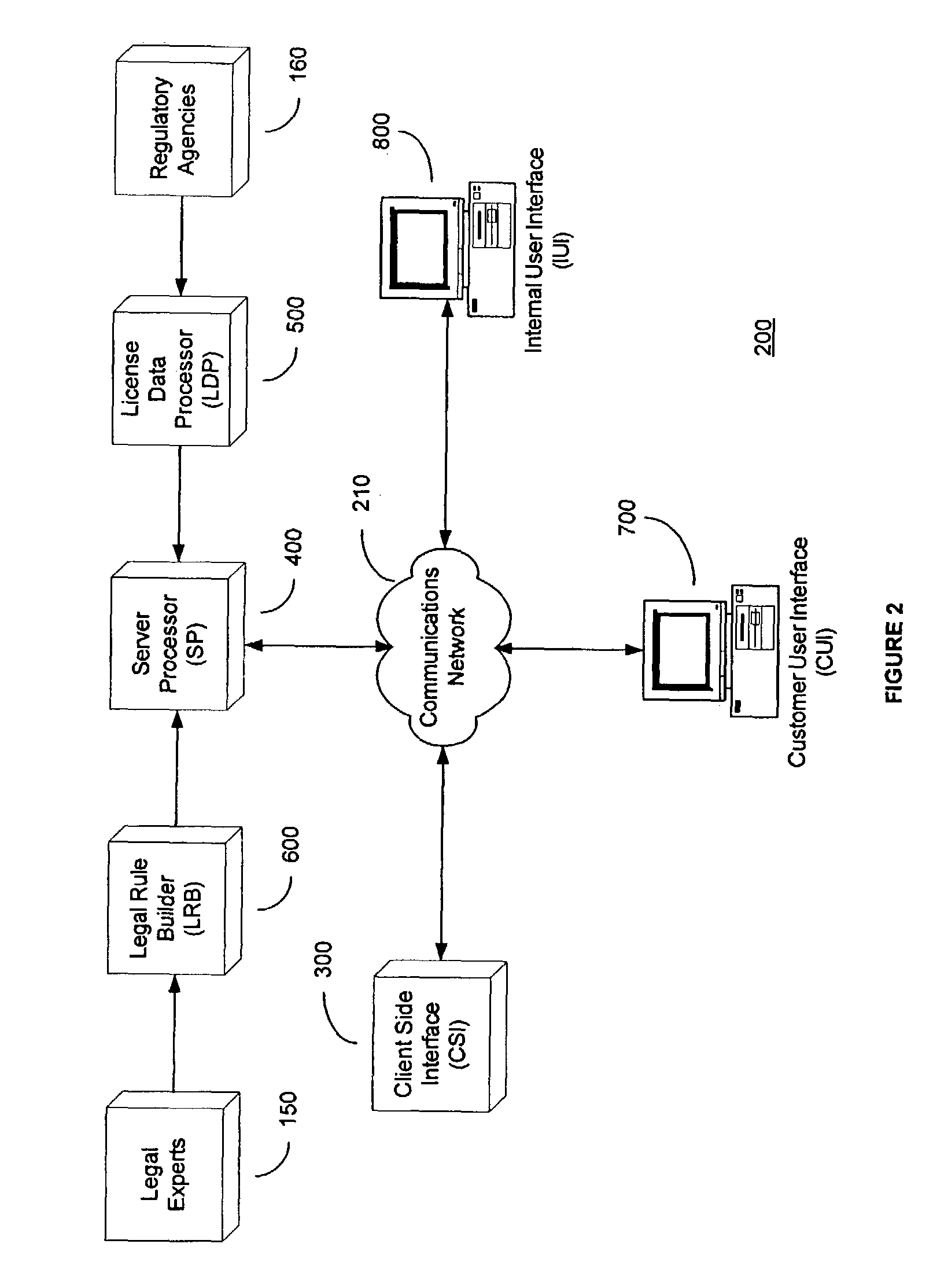

System and method for automated loan compliance assessment

An automated system and method for reviewing and assessing compliance with legal compliance requirements for loan applications. Loan application data is extracted from client loan origination systems and transmitted as a loan information file over a secure communication network to an automated compliance assessment system server where the loan information file is audited for compliance with Federal, state, and local legal compliance requirements. The loan information file is reviewed for legal compliance requirements imposed by Federal, State, and local jurisdictions, as well as licensing requirements that the client loan company and related personnel must satisfy. The results of the audit process are transmitted over a secure communication network to the client loan company, with areas of noncompliance indicated. The automated compliance assessment system server also stores rules data derived from legal compliance requirements, license data derived from regulatory requirements, system setup data and supplemental system application data.

Owner:ICE MORTGAGE TECH INC

Virtual pooled account for mobile banking

ActiveUS7873573B2Reduce settlement and operational cost of systemThe process is simple and fastComplete banking machinesFinanceOperational costsSimulation

A virtual pooled account is used in operating a system having multiple financial partners. In a specific implementation, the system is a mobile banking system. Instead of maintaining separate general ledgers for each financial institution, the system will keep one general virtual pooled account. This will reduce the settlement and operational costs of the system. The owner of the virtual pooled account will receive the float on the virtual pooled account, and this float will be distributed to the multiple financial partners according to a formula.

Owner:OBOPAY MOBILE TECH INDIA PTE LTD

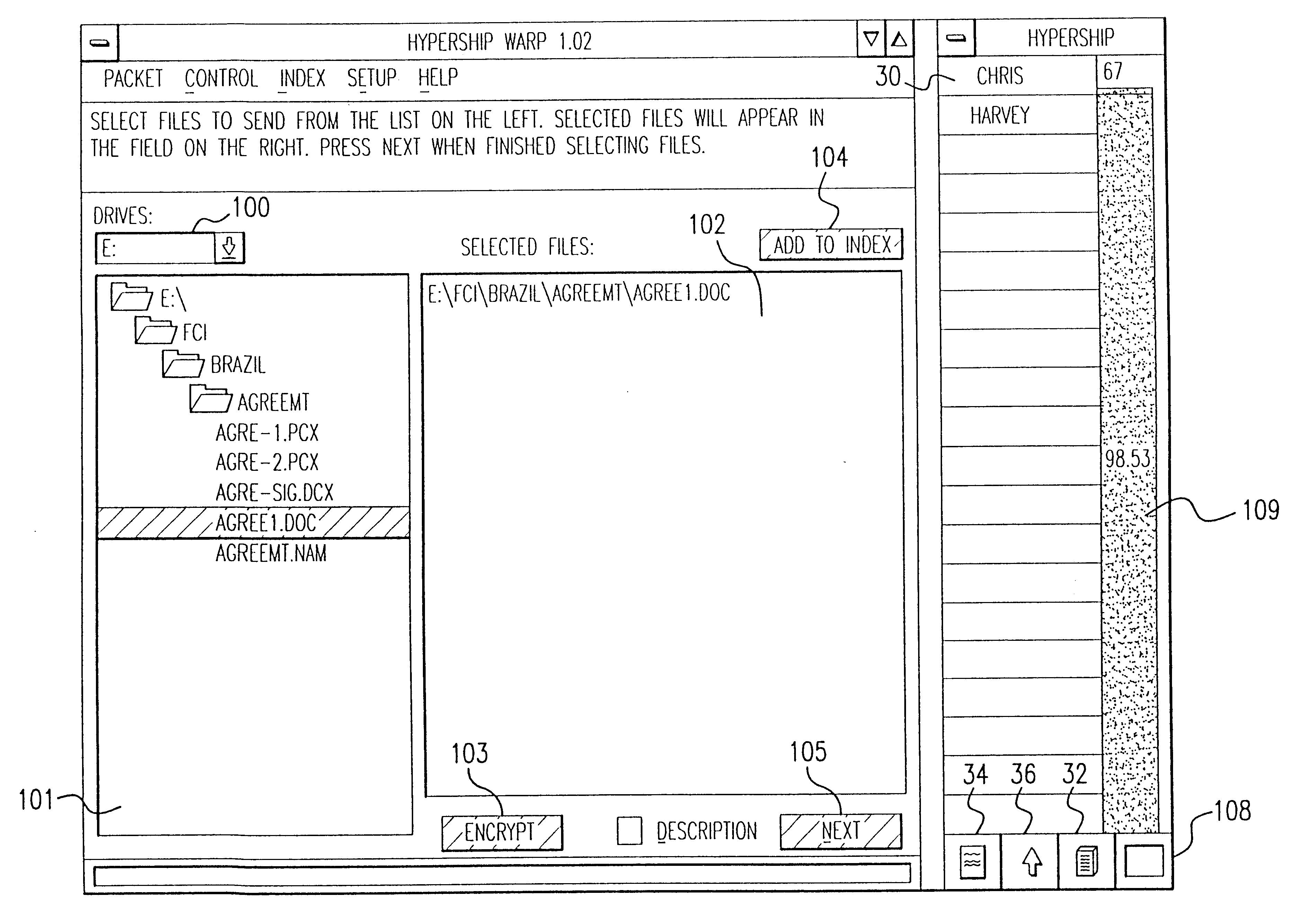

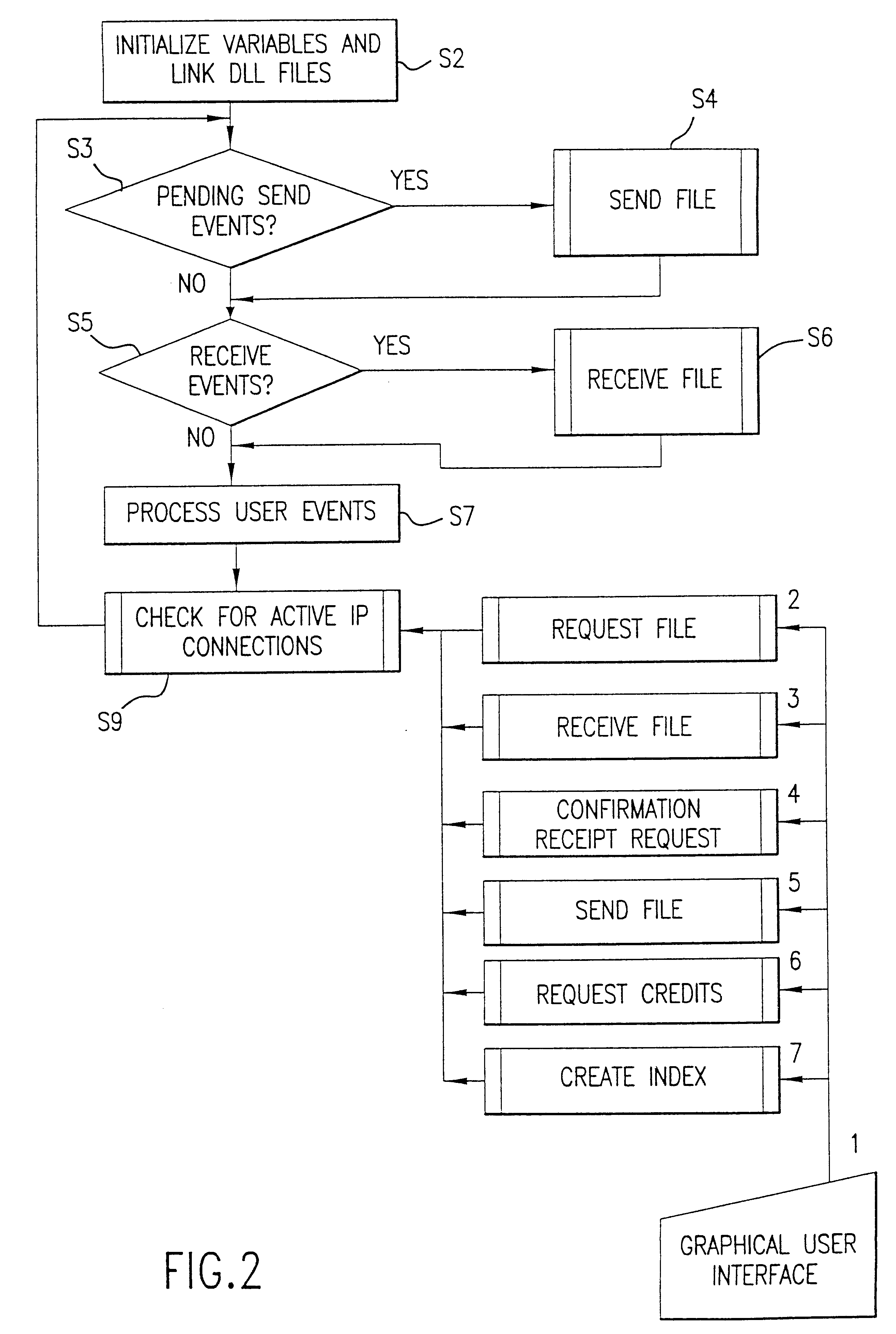

Methods and apparatus for secure electronic, certified, restricted delivery mail systems

A computer data signal embodied in a propagation medium is provided. The signal enables a variable number of data transfers and includes an initial connection source code segment and a data transfer source code segment. The initial connection source code segment establishes a connection between at least two devices via predetermined listening ports, with at least one predetermined listening port residing within each device. The initial connection source code segment also dynamically assigns a first data port within a first device, and transmits the address of the first data port to a remaining device via the predetermined listening ports. The data transfer source code segment is for each of the variable number of data transfer operations. The data transfer source code segment dynamically assigns a corresponding second data port within the remaining device and transfers data between the connected devices via the data ports so that the data is substantially simultaneously transferred between a variable number of devices via the data ports. Each pair of first and second data ports is established in response to each listening port connection.

Owner:INTELLECTUAL VENTURES I LLC

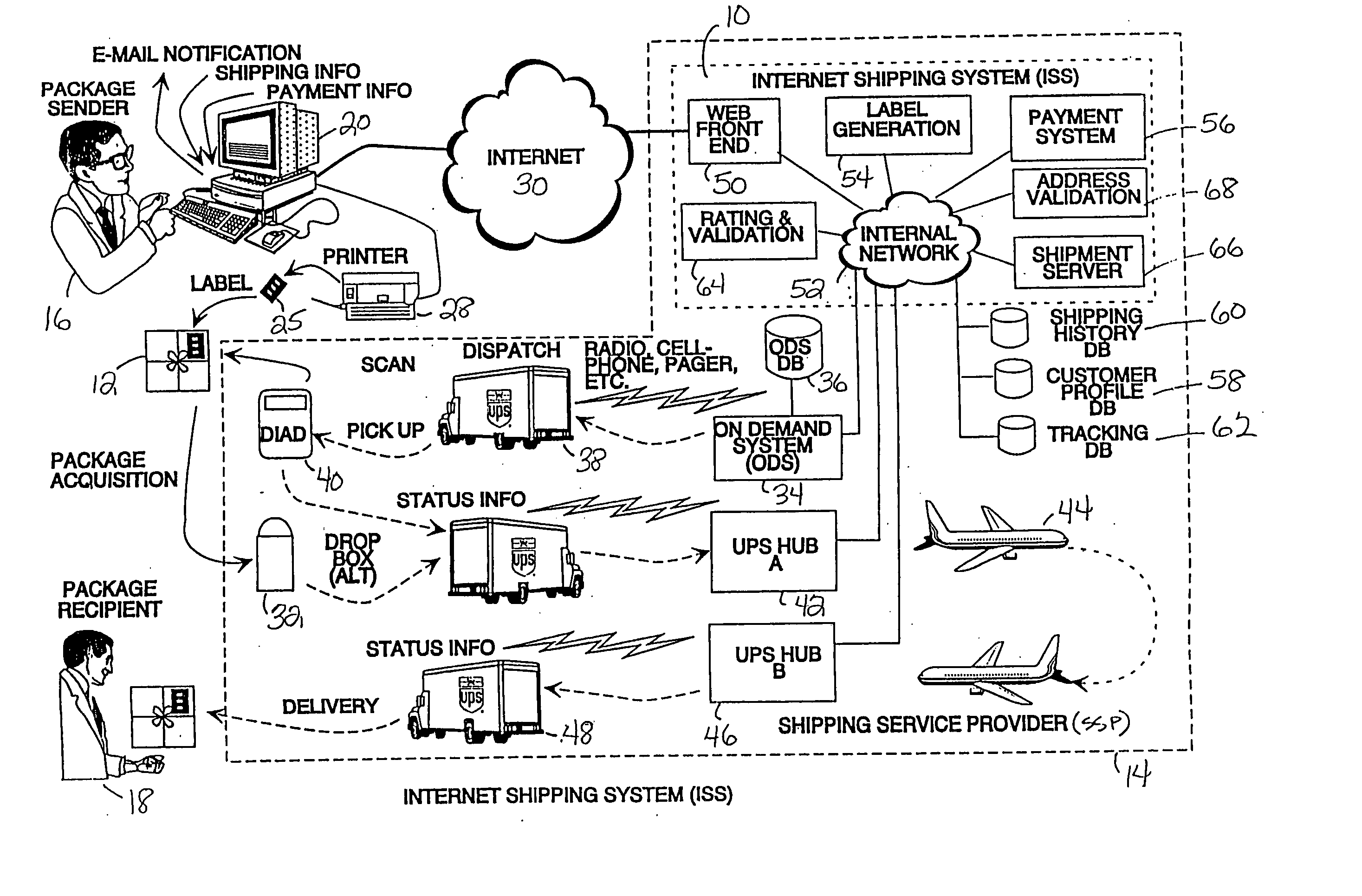

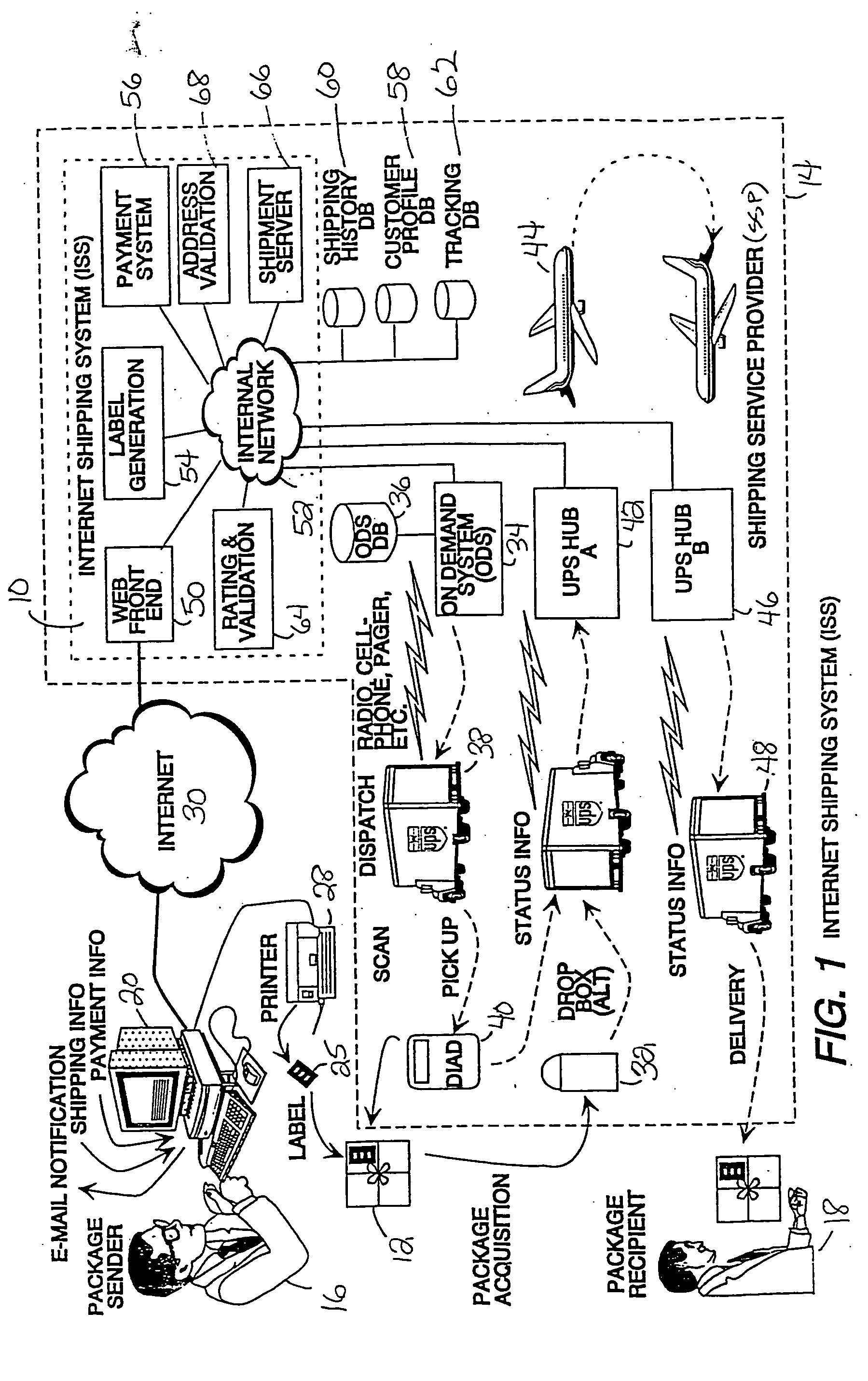

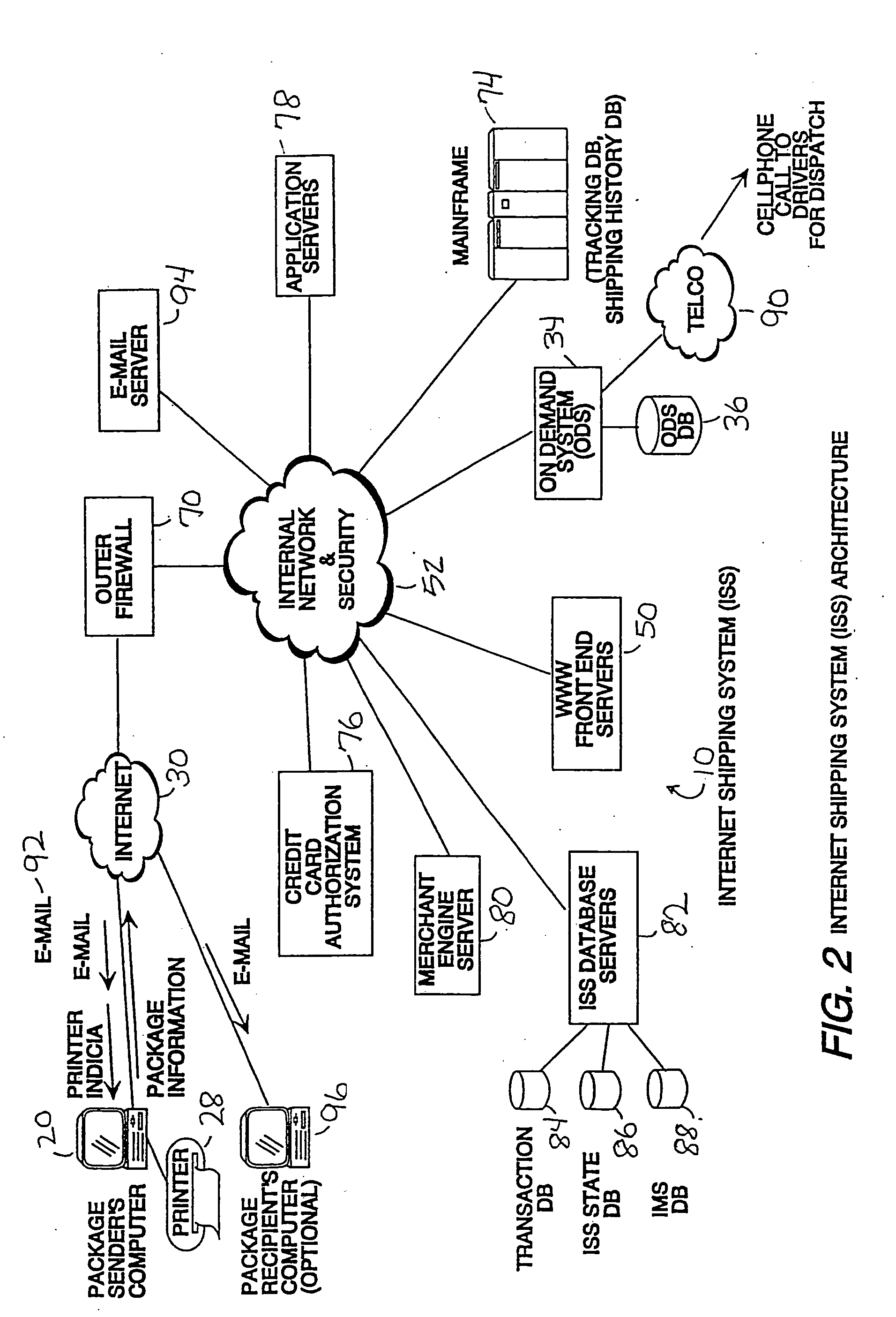

Internet package shipping systems and methods

ActiveUS20050038758A1Convenience and securityFlexibility securityFranking apparatusStacking articlesPaymentInternet communication

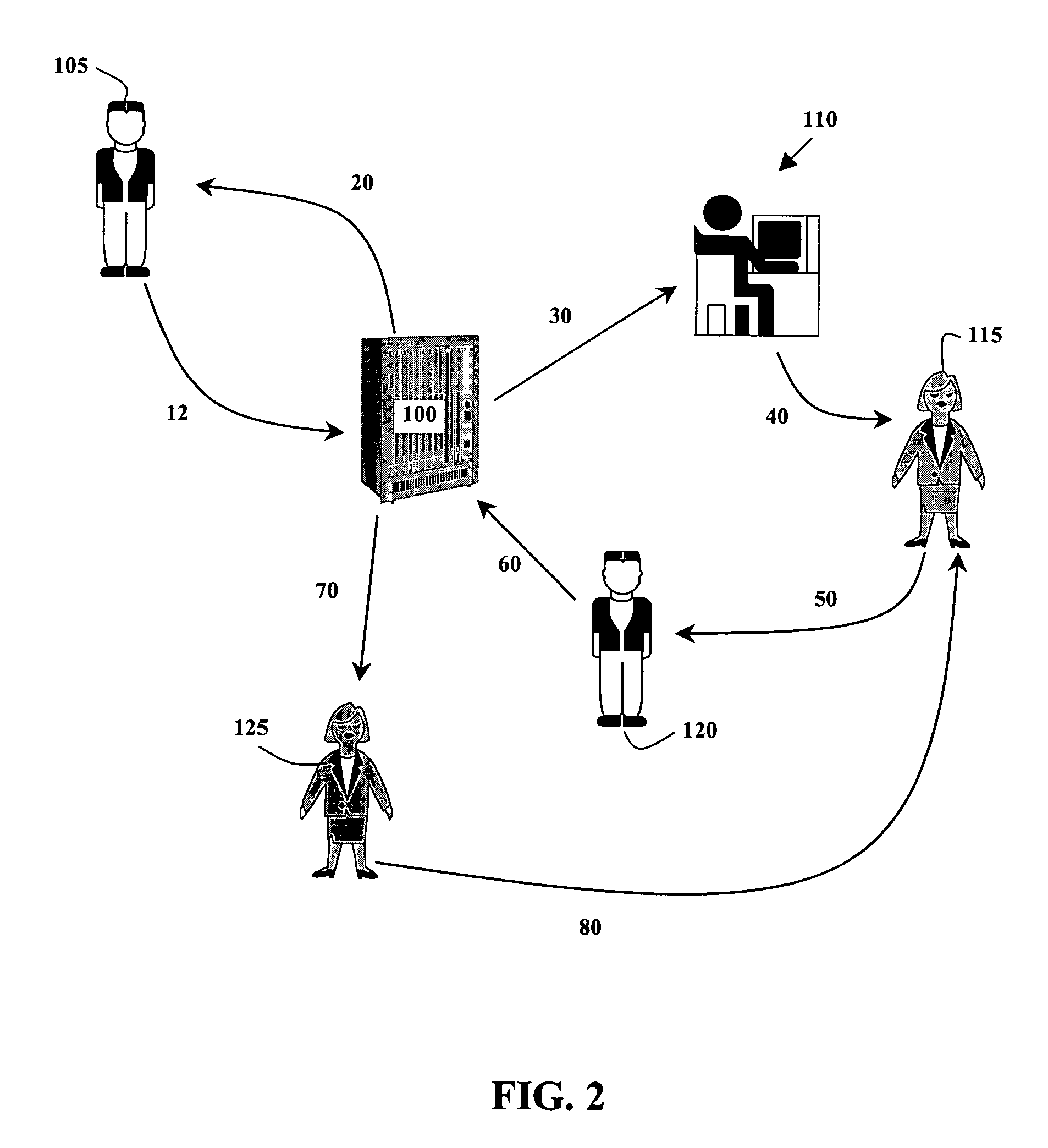

A system and methods for shipping a package (12) from a package sender (16) to an intended recipient (18), utilizing Internet communications (30) to place shipping orders, request on demand package pickup, maintain and utilize prestored profile information, view shipping history, track orders, etc. A package sender (16) with an Internet-accessible computer (20) accesses an Internet site and associated shipping system (10) operated by a shipping service provider (14). The package sender (16) enters information required for shipping the package (12), including shipping options and methods for payment. The options and payment for the shipment transaction are validated. If the transaction is validated, printer indicia are communicated to the customer's computer (20), which is enabled to locally print a prepaid label (25) containing special machine-readable (876) as well as human-readable indicia (904). The shipping service provider (14) acquires the package by drop-off, standard pickup or on call pickup, scans the machine readable indicia, verifies other indicia of authenticity, and processes the package (12) in accordance with information encoded on the label.

Owner:UNITED PARCEL SERVICE OF AMERICAN INC

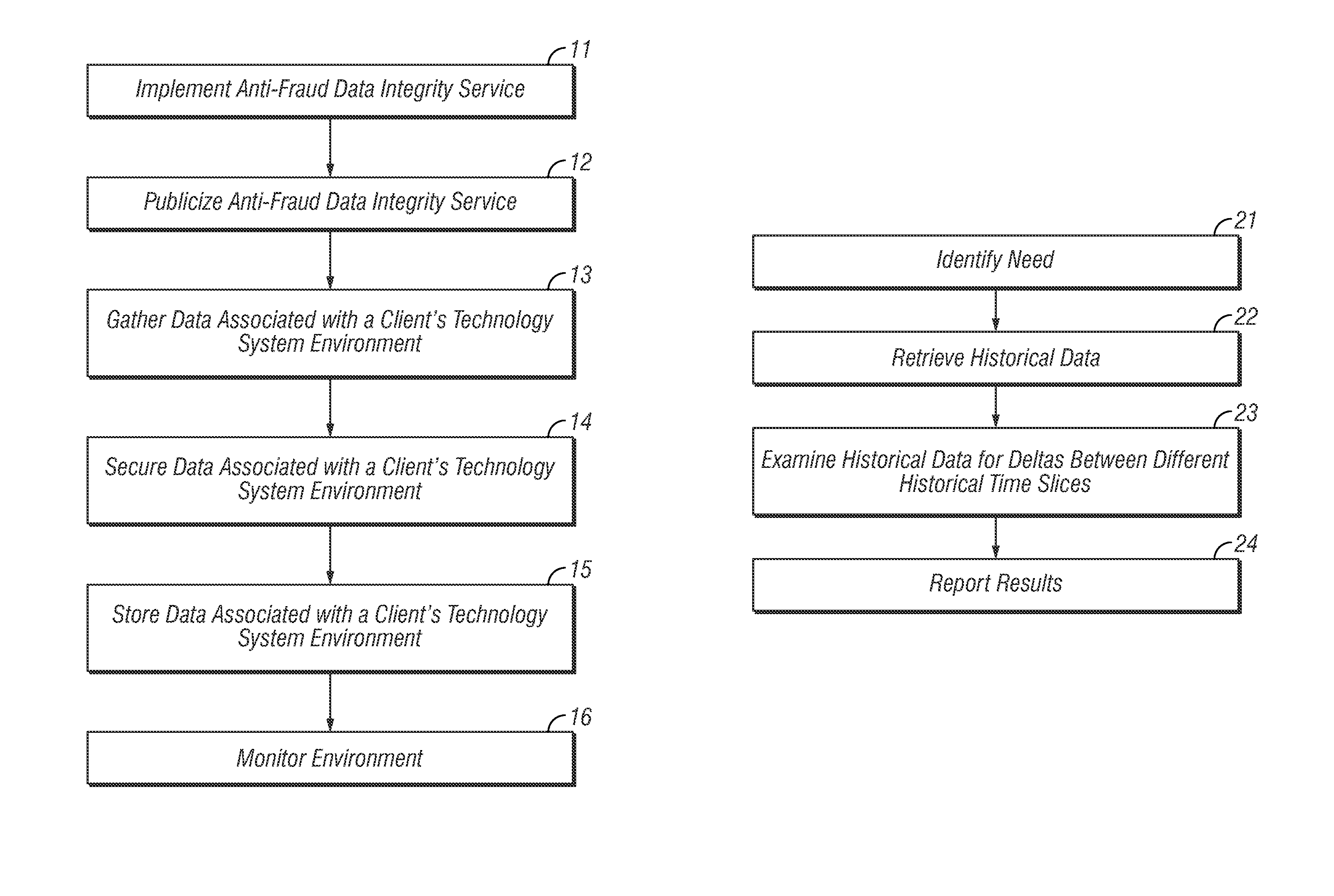

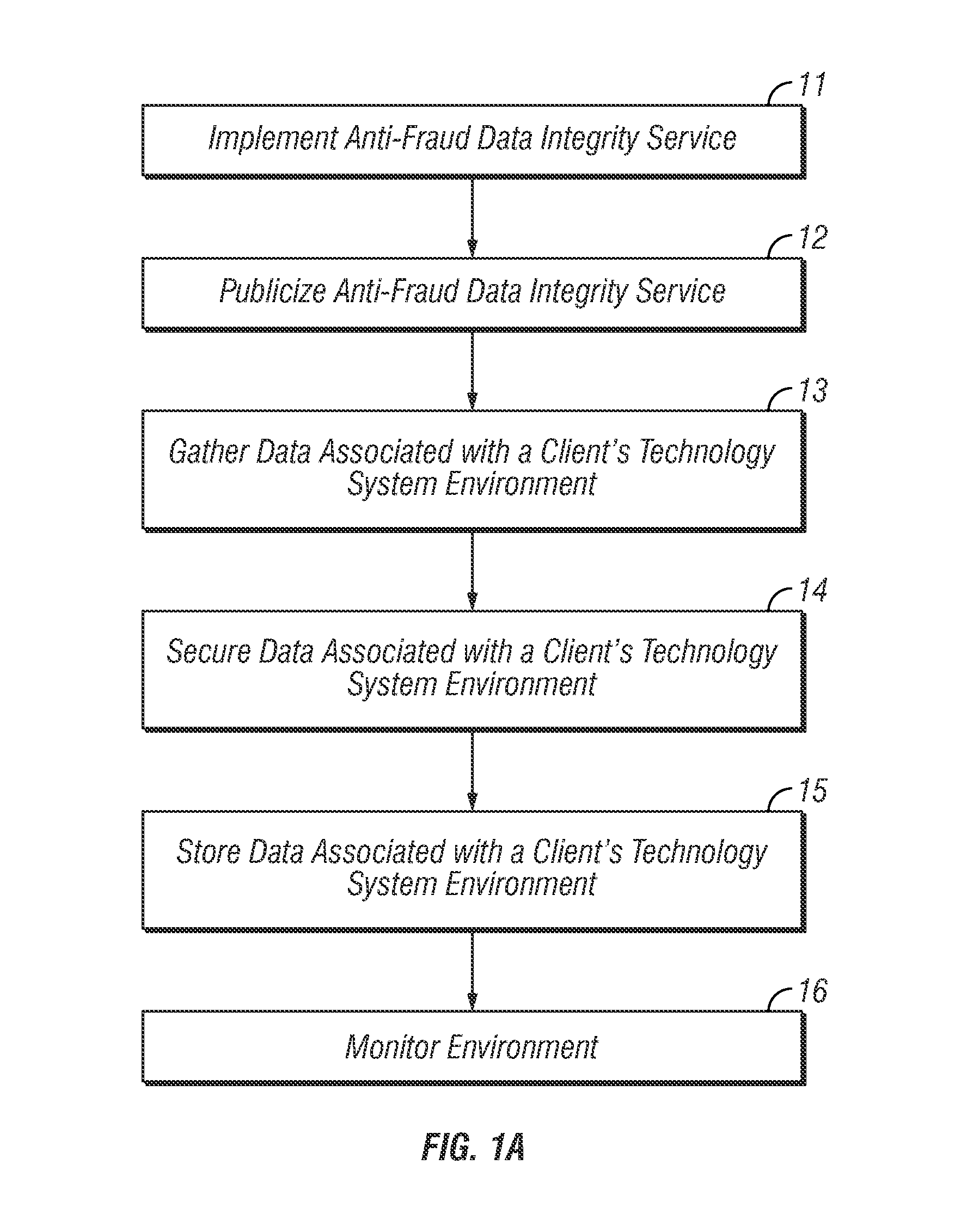

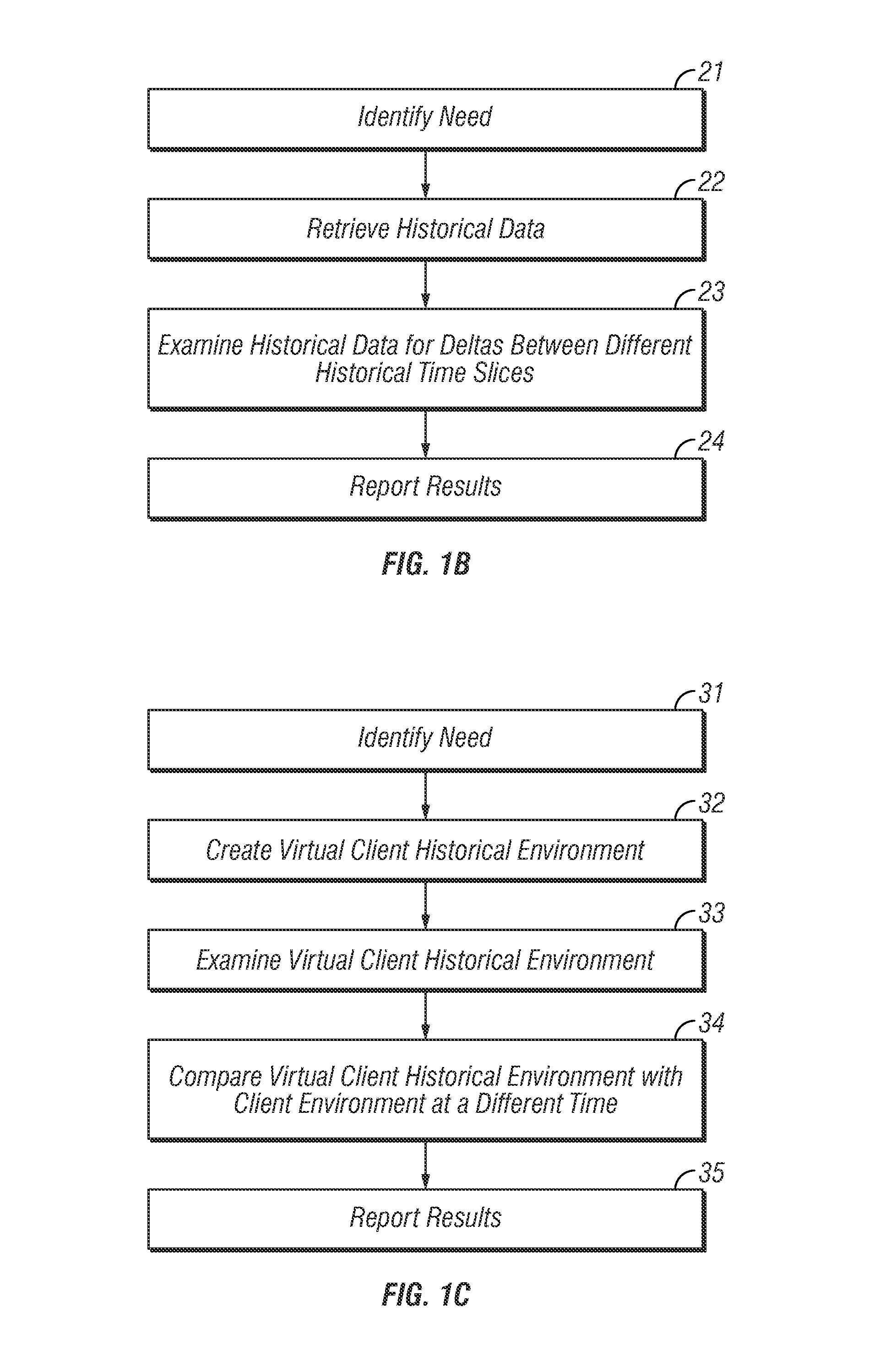

Method and apparatus for maintaining high data integrity and for providing a secure audit for fraud prevention and detection

ActiveUS8805925B2Easy to findReduce the burden onComplete banking machinesFinanceData integrityInvoice

Owner:NBRELLA

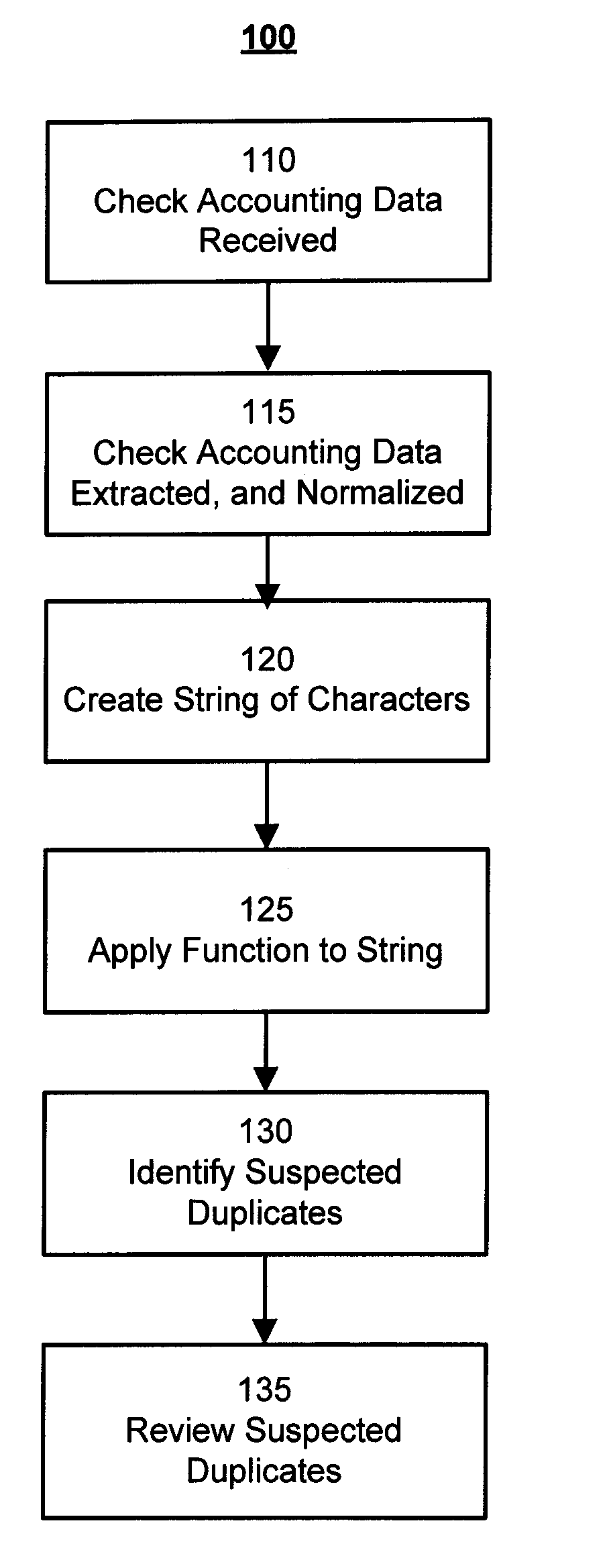

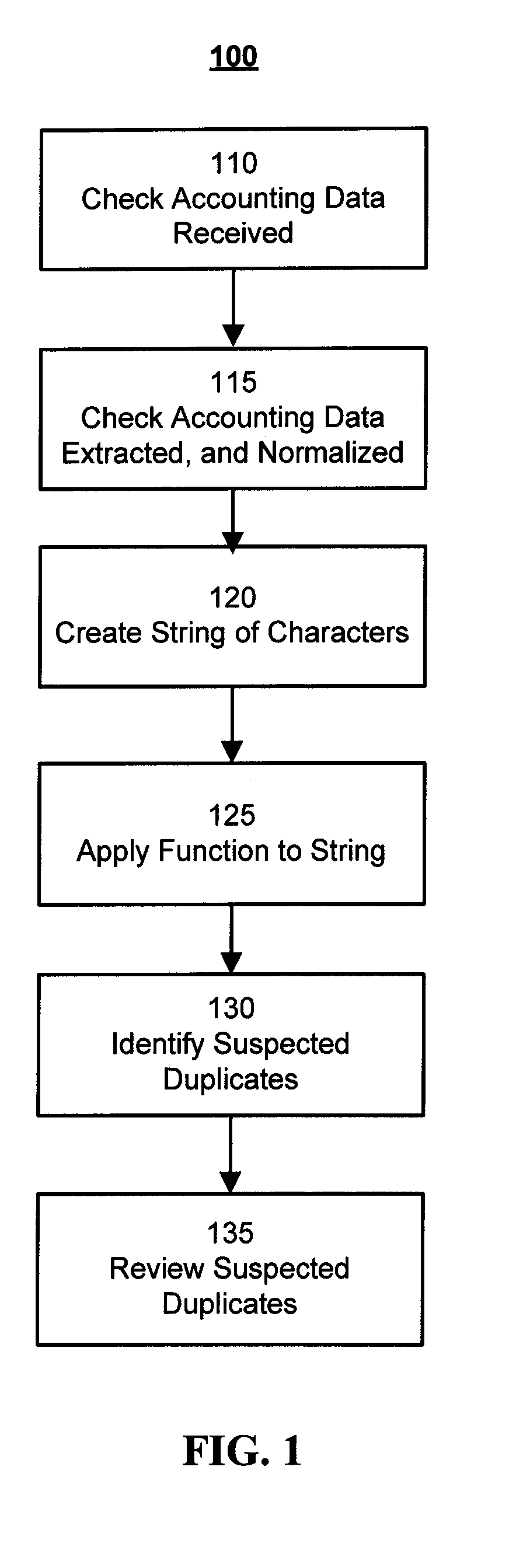

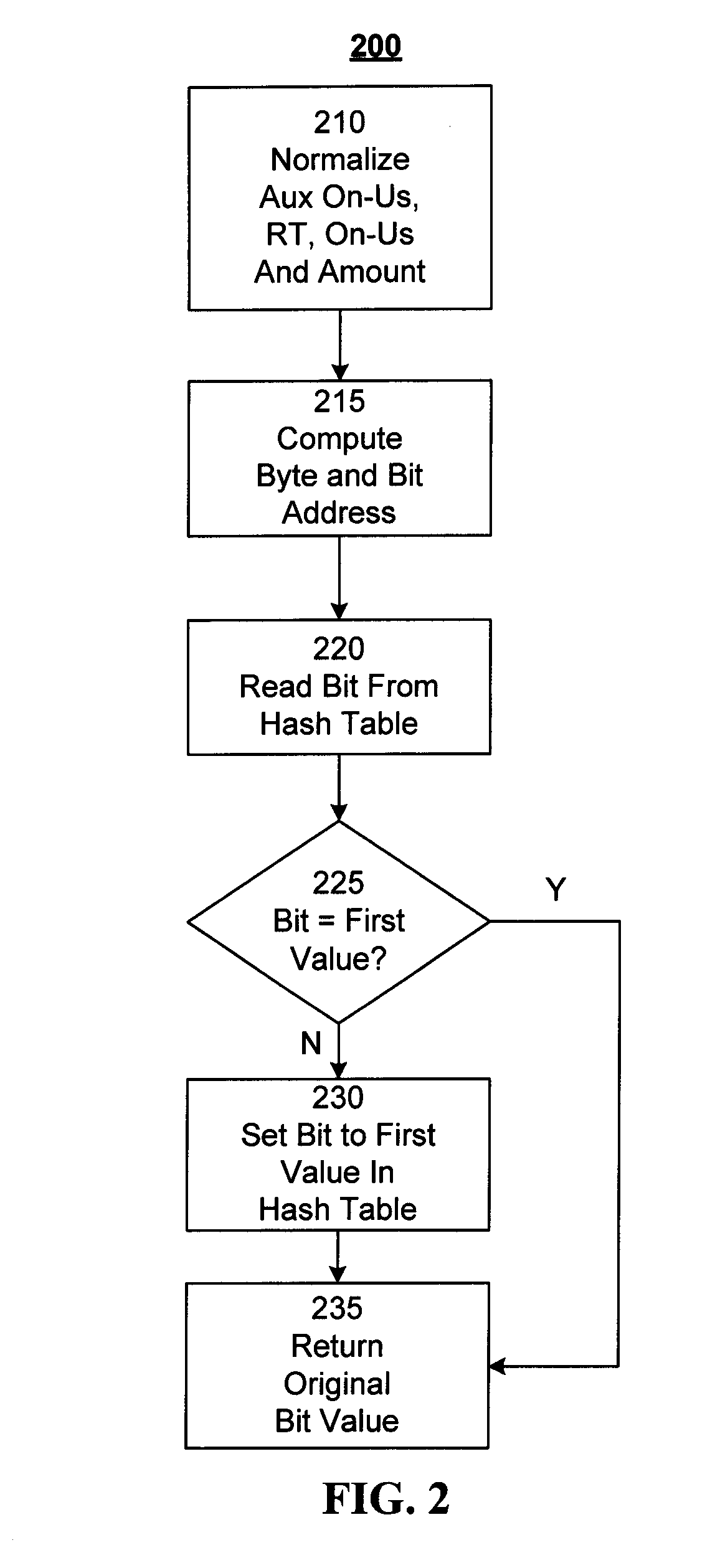

Method and System for Duplicate Check Detection

ActiveUS20100098318A1Reduce false positive rateMinimize table sizeComplete banking machinesFinanceHash functionBloom filter

A system and method for detecting duplicate checks during processing. The duplicate detection may be performed by a financial institution, such as a bank. The method may be implemented on a computer based system. The duplicate detection method may be automated. The method may be applied to incoming check files prior to processing of the check data to prevent processing of duplicate checks. The system and method may use a function, such as a hash function, to perform the duplicate detection. Other functions, such as a Bloom filter which may use multiple hash functions, may be used to perform the duplicate detection.

Owner:JPMORGAN CHASE BANK NA

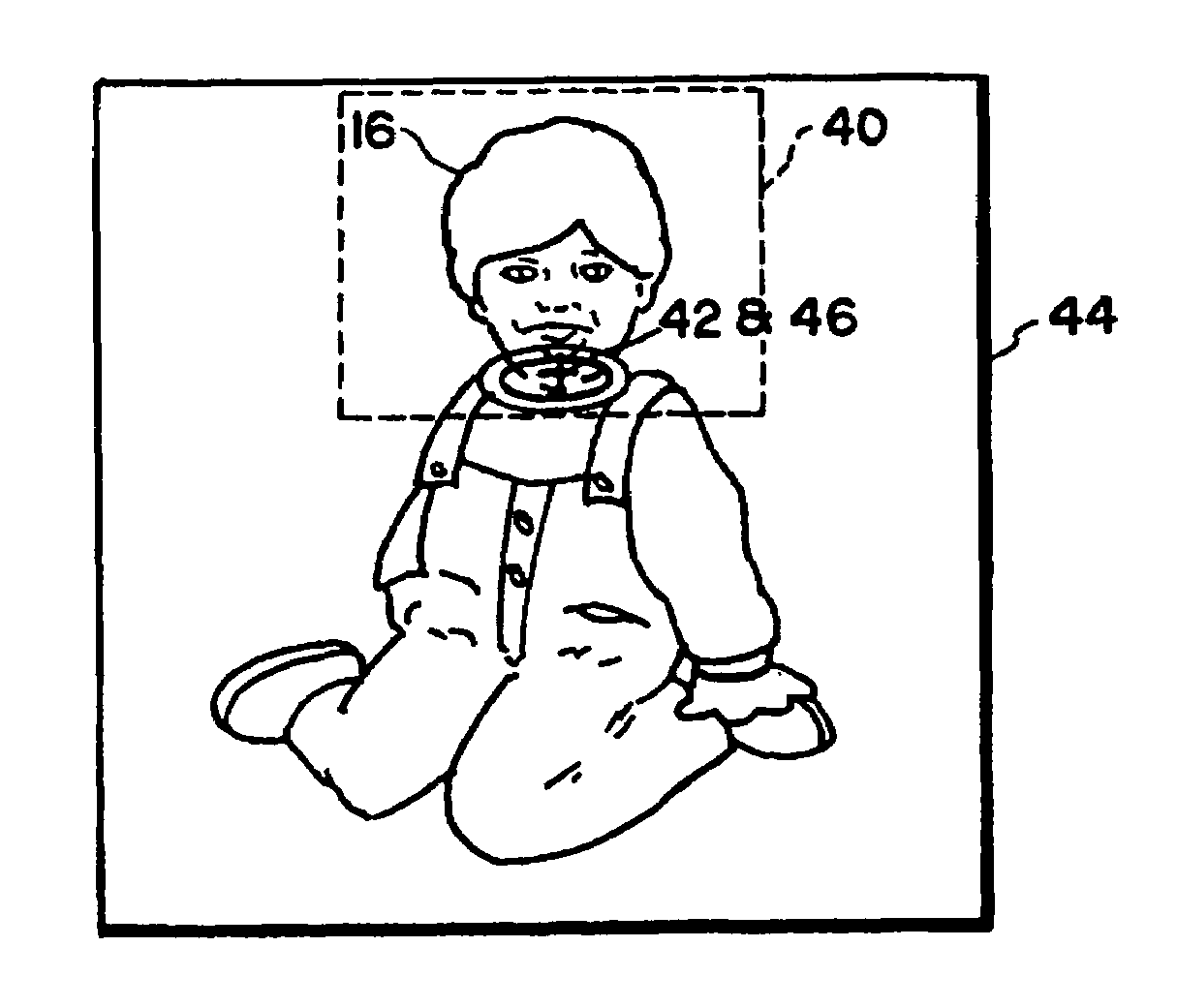

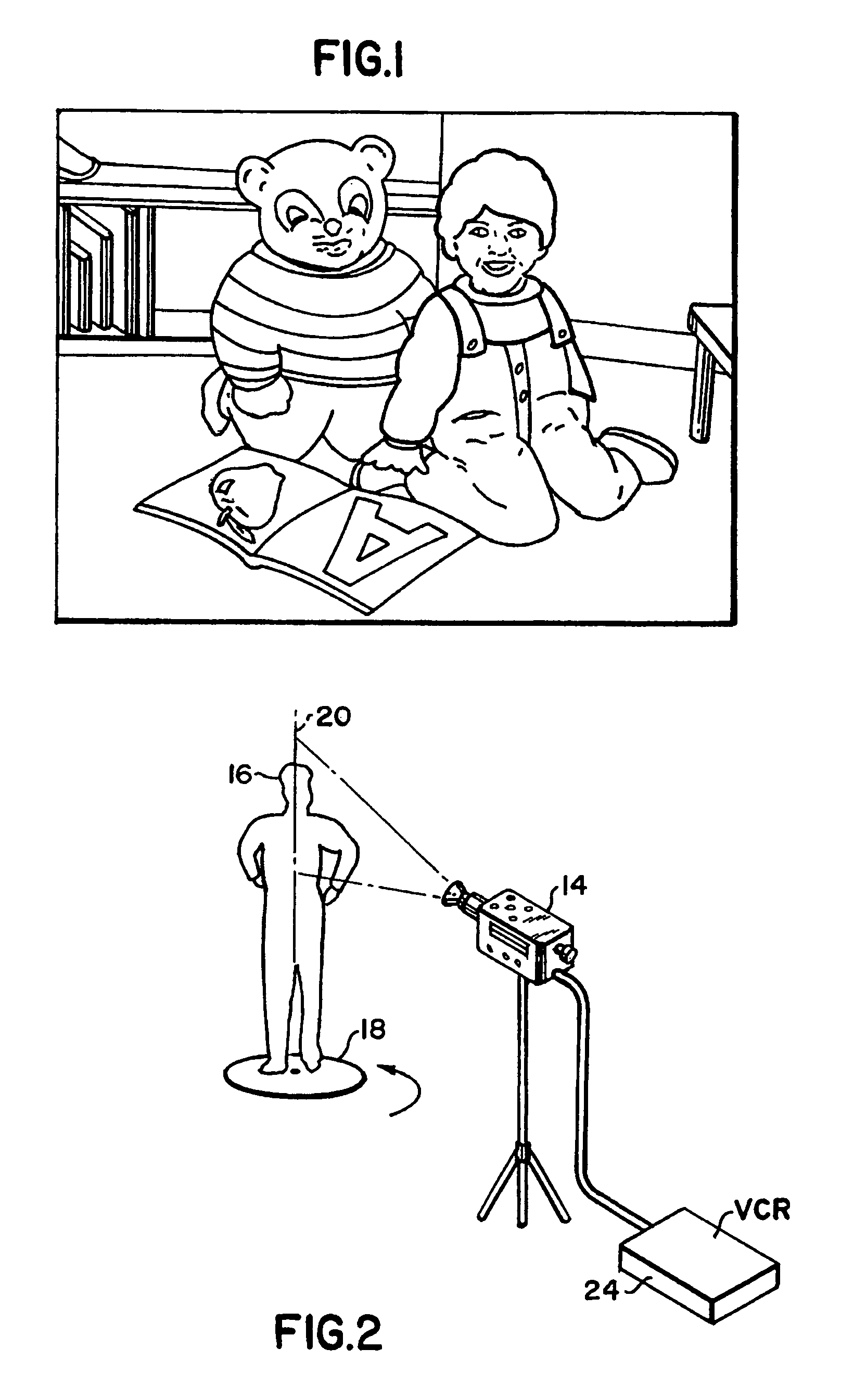

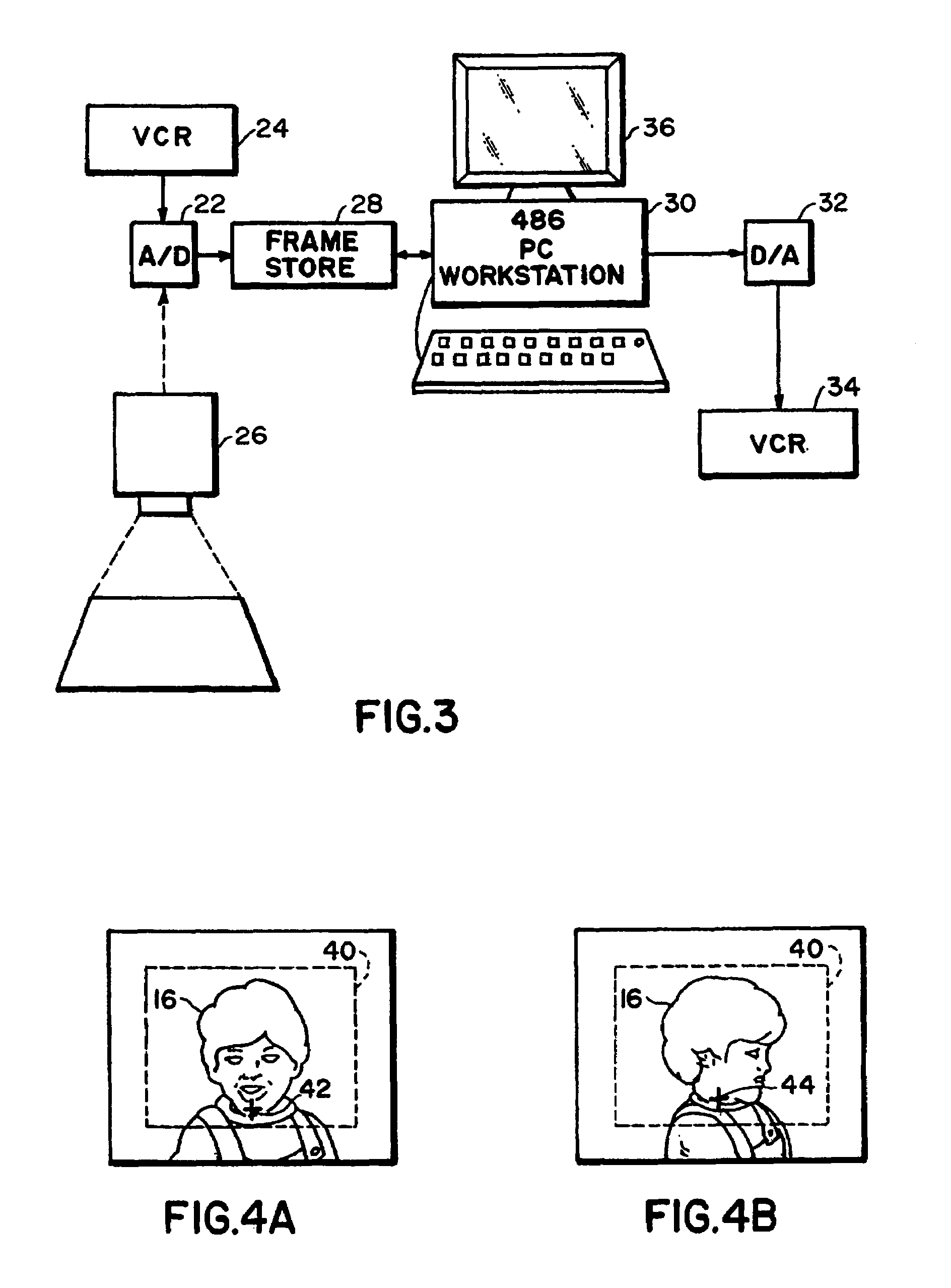

Object customization and presentation system

InactiveUS7859551B2Less time-consumingLess costlyTelevision system detailsPicture framesPersonalizationPrint version

A method for generating a personalized presentation, comprising providing an Internet browser user interface for selecting an image and a surrounding context; receiving the selected image and surrounding context by an Internet web server; accounting for the user activity in a financial accounting system; and delivering the selected image and surrounding context to the user. The surrounding context may comprise a physical frame for a picture, with a printed version of the selected image framed therein. The accounting step may provide consideration to a rights holder of the selected image, or provide for receipt of consideration from a commercial advertiser. A plurality of images may be selected, wherein the context defines a sequence of display of the plurality of images.

Owner:BIG TENT ENTERTAINMENT +1

Method, transaction card or identification system for transaction network comprising proprietary card network, eft, ach, or atm, and global account for end user automatic or manual presetting or adjustment of multiple account balance payoff, billing cycles, budget control and overdraft or fraud protection for at least one transaction debit using at least two related financial accounts to maximize both end user control and global account issuer fees from end users and merchants, including account, transaction and interchange fees

InactiveUS20070168265A1Increase flexibilityEasy maintenanceComplete banking machinesFinanceCredit cardFinancial transaction

The present invention provides methods, systems and transaction cards or identification systems, using transaction network comprising proprietary card network, EFT, ACH, or ATM, for end user management of a global financial account by manual or automatic prepaying, prepaying, paying or unpaying, debiting or crediting, or readjustment or presetting, using parameters relating to portions of paid or unpaid financial transactions or account balance amounts in multiple credit, cash or other existing, or end user created, financial accounts or sub-accounts in said global financial account that is optionally subject to financial account issuer transaction or readjustment fees from end users and merchants, including optional use for financial transactions as a credit transaction card requiring merchant credit card interchange or other fees, and optional end user fees, as additional revenue to the global account issuer.

Owner:ROSENBERGER RONALD JOHN

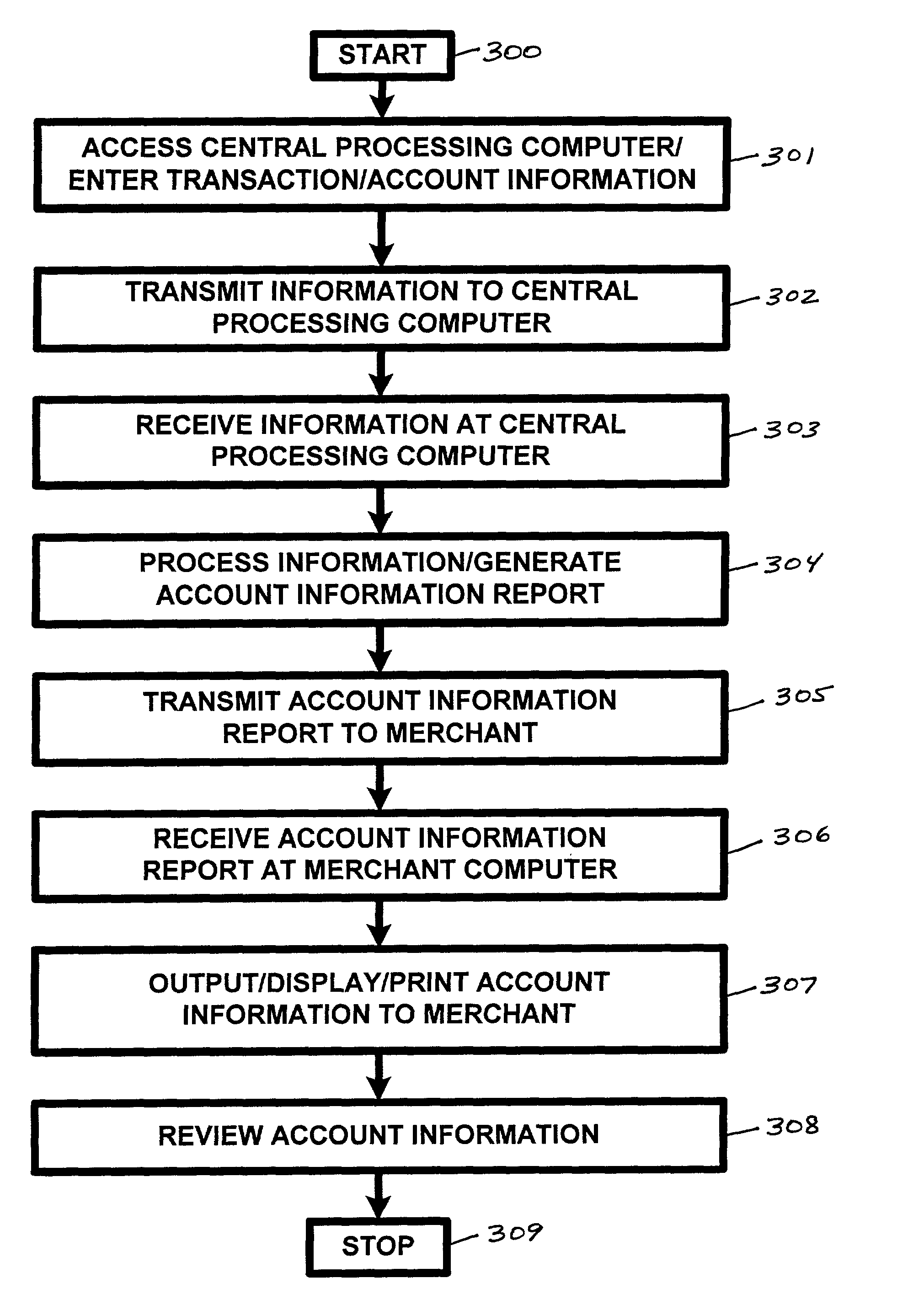

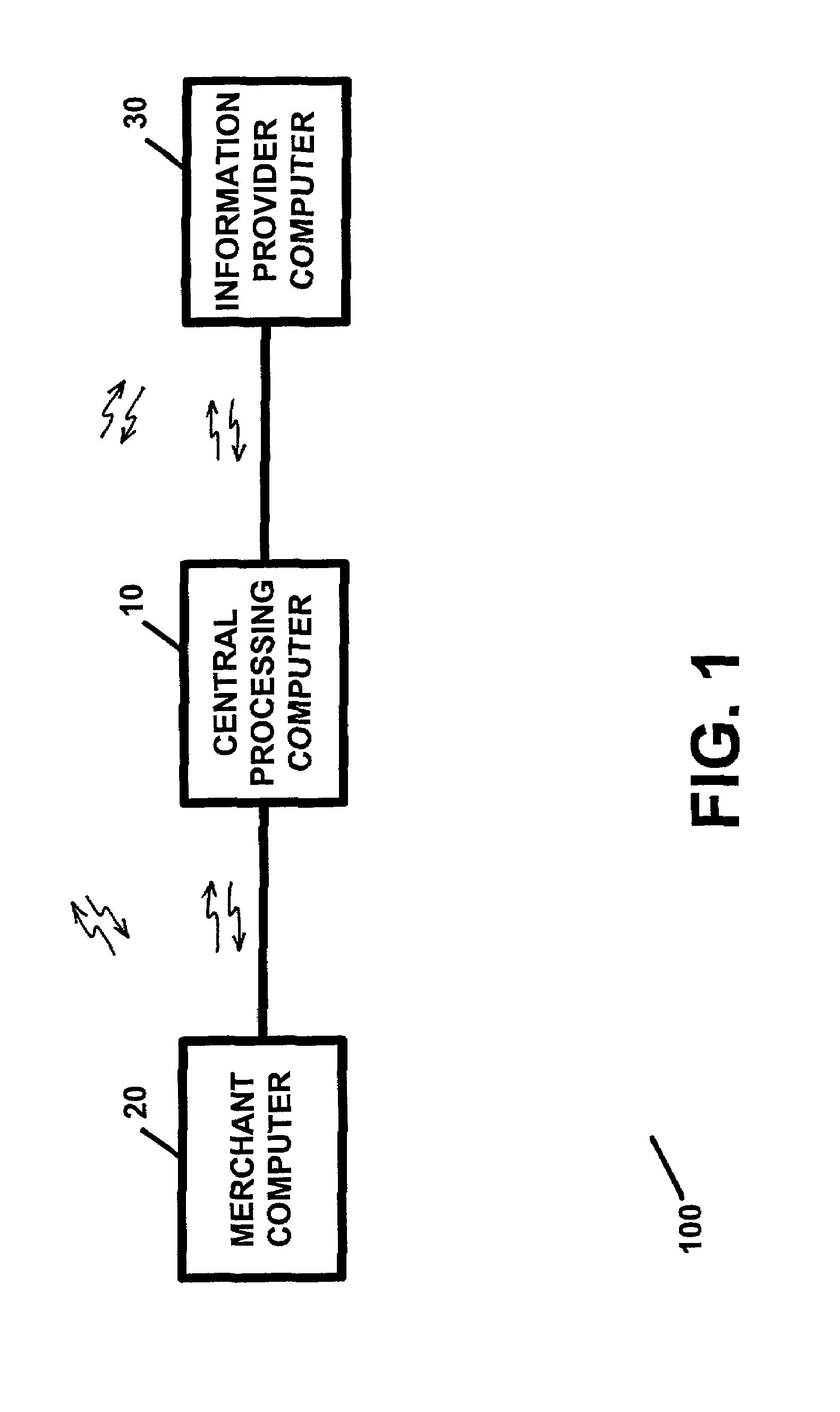

Apparatus and method for providing transaction history information, account history information, and/or charge-back information

A computer-implemented method, including receiving information regarding a transaction involving an account, wherein the information regarding the transaction is received by a receiver prior to a processing, a completion, a consummation, or a cancellation, of the transaction, processing the information regarding the transaction with a processing device using information regarding the account, generating a report or a message in response to the processing of the information regarding the transaction, wherein the report or the message contains information regarding a charge-back regarding a previous transaction involving the account, and transmitting the information report to a communication device associated with a merchant, vendor, or provider, of a good, product, or service.

Owner:CASELAS LLC

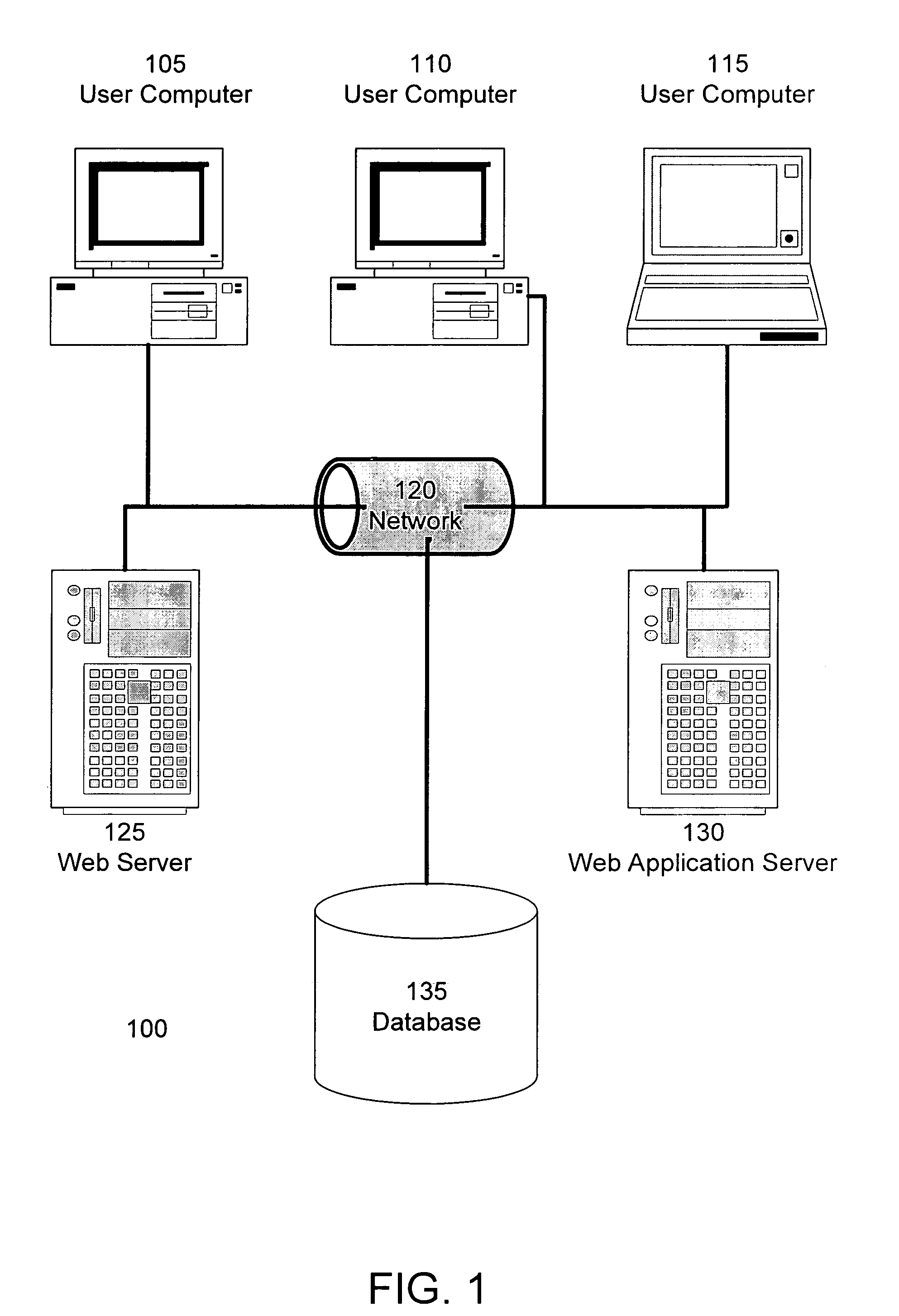

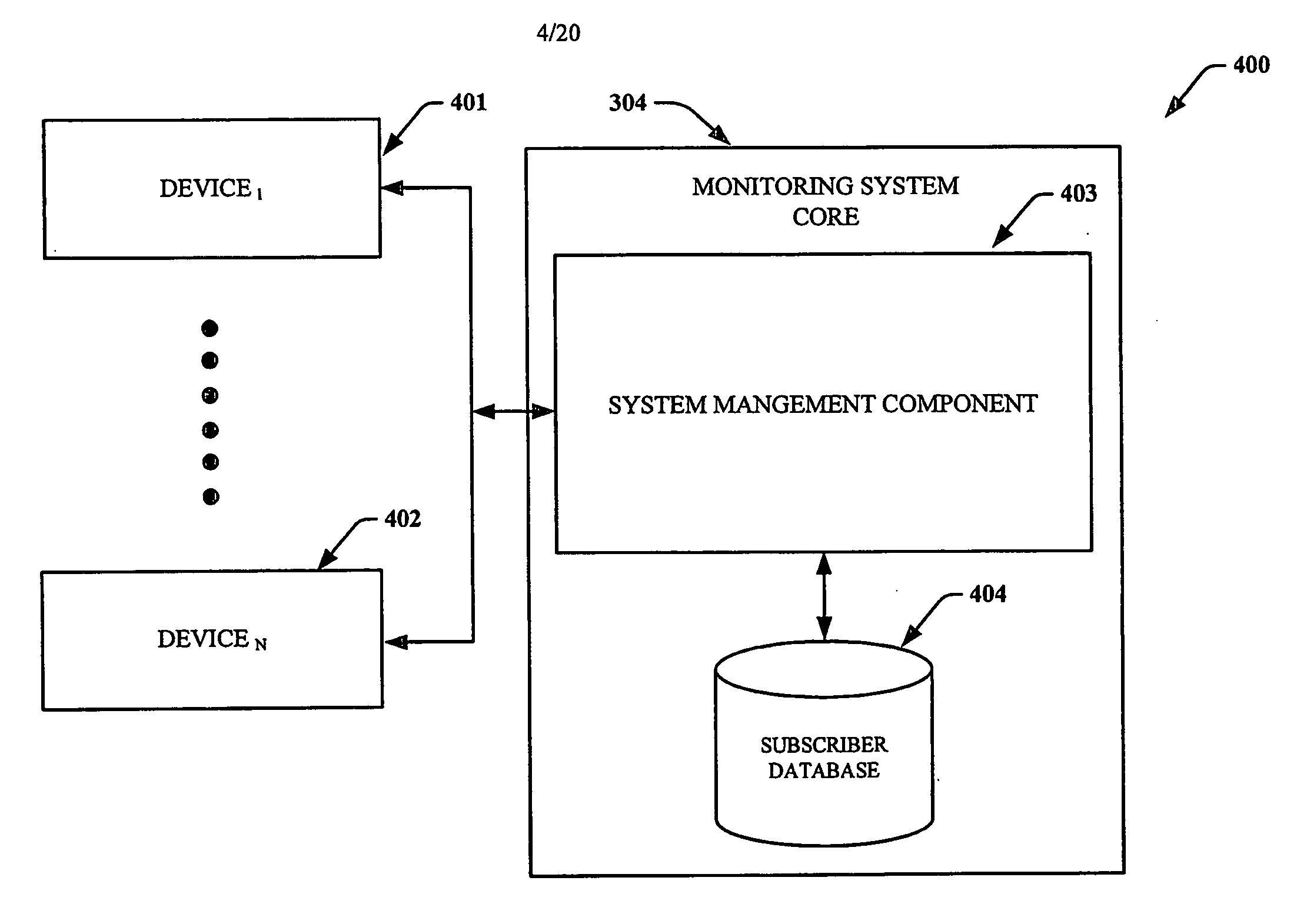

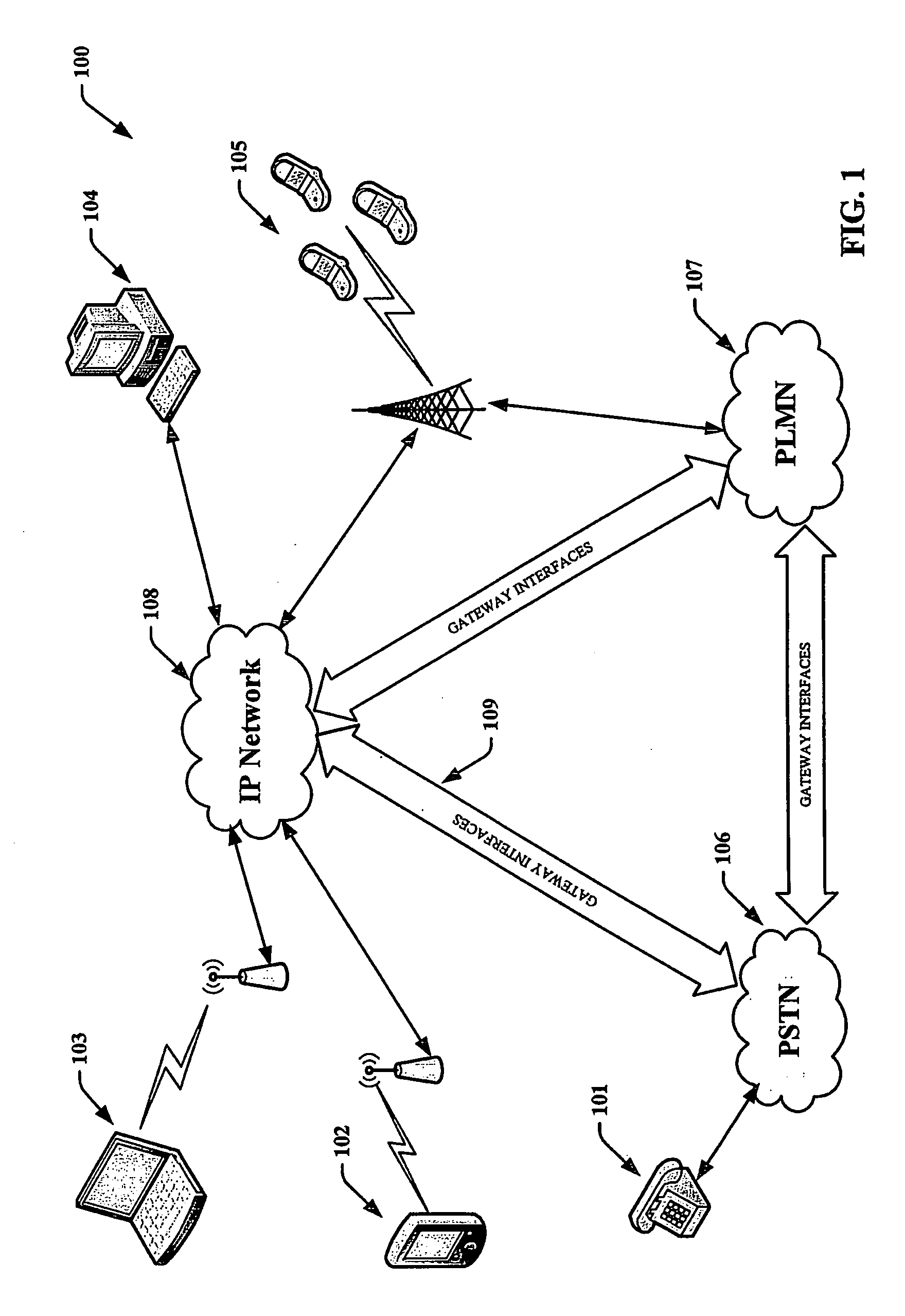

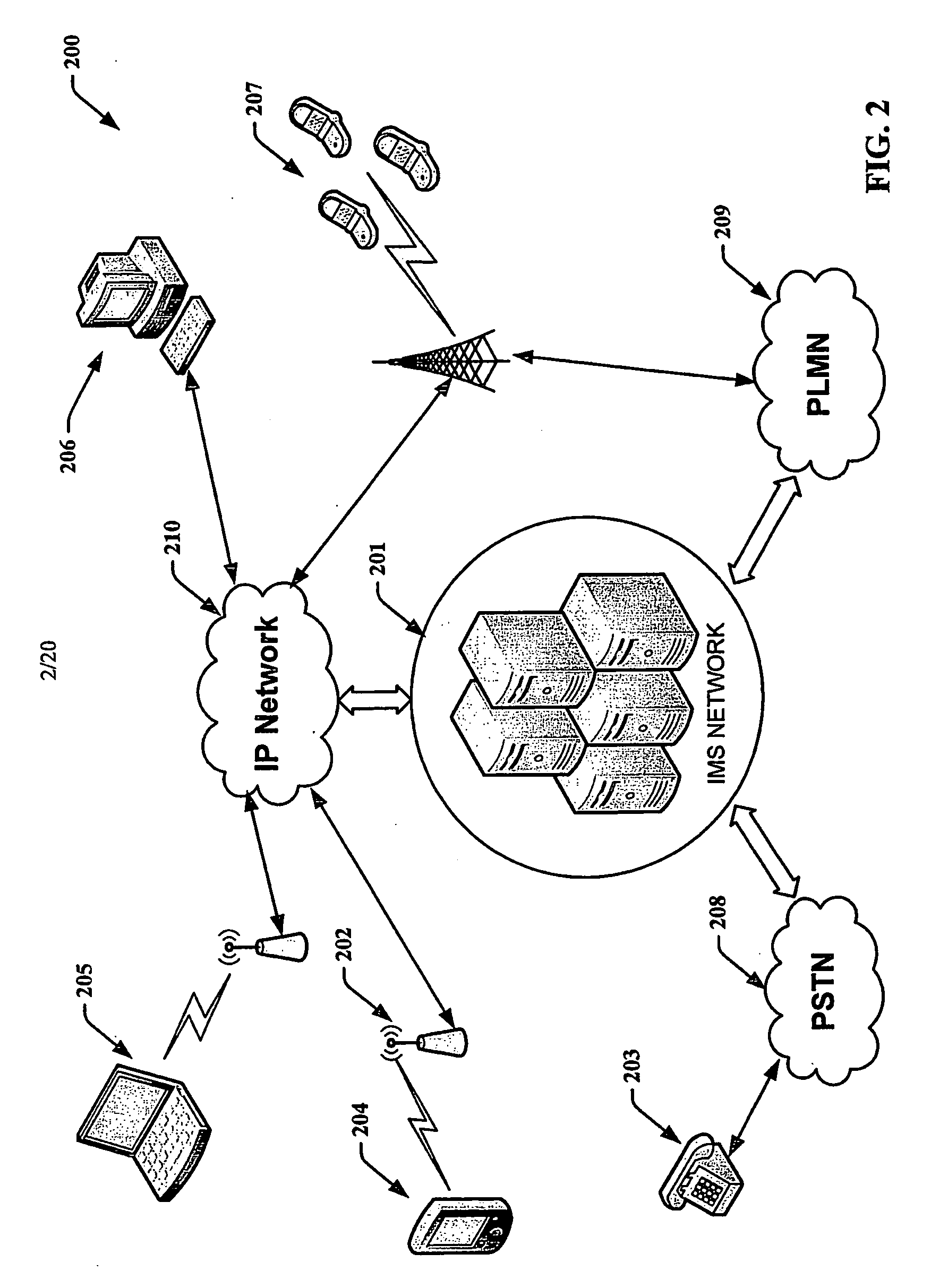

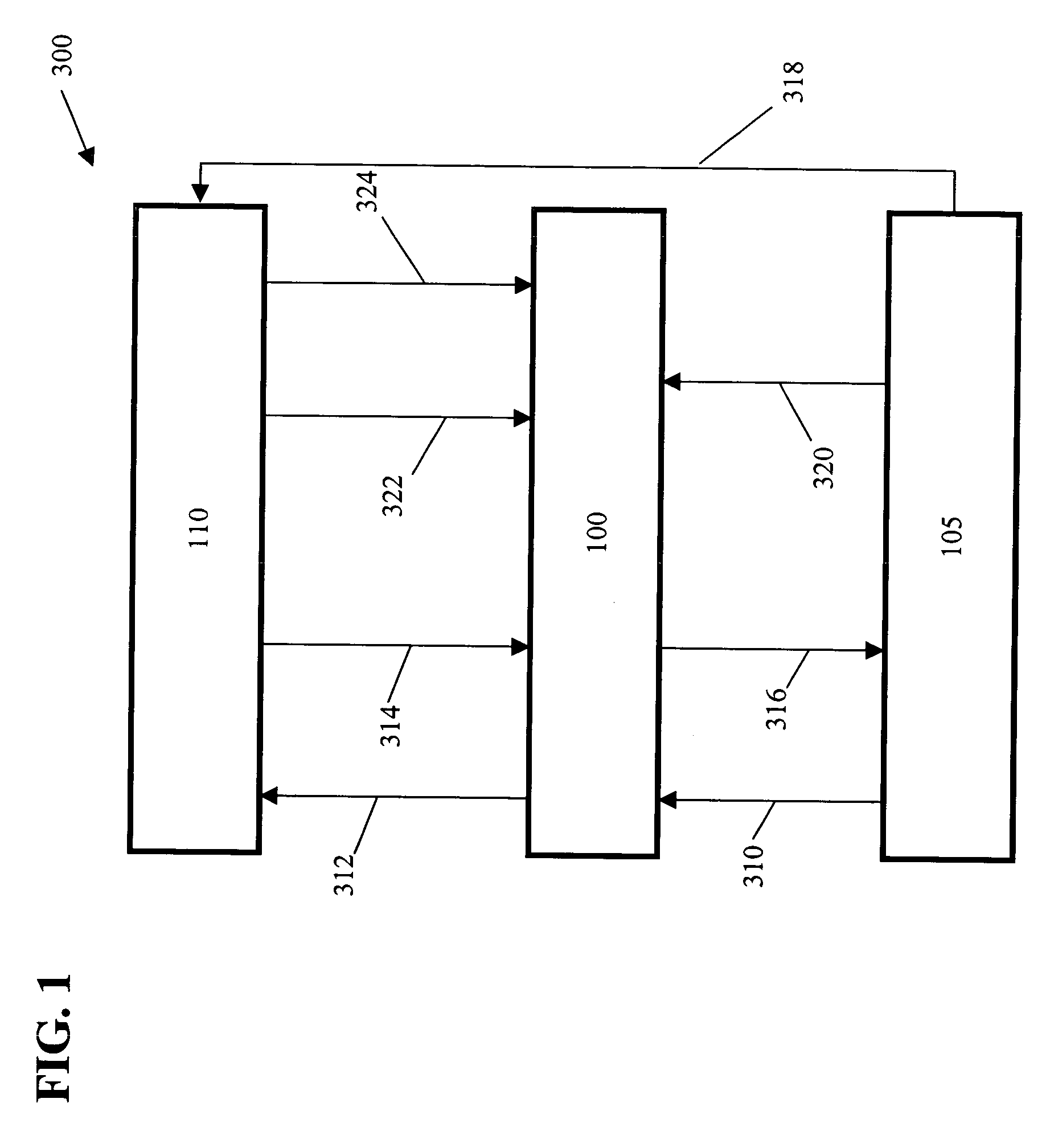

Usage data monitoring and communication between multiple devices

A system and method for by which real-time monitoring and communication of usage data is conducted between a set of N numbered of devices where N is and integer. According to an embodiment, a communication network provides a common core architecture in which the devices connected to the system are converged regardless of their access network requirements or functional capacity. The system has the capacity to monitor and analyze all the usage information of each device connected to the system in regards to content, identity, type, quality, quantity, time, status, activity level, and metadata associated with the functions and applications utilized on a device. The analysis is further based on information governing a subscriber's devices, preferences, and features held in a subscriber database integrated within the system. The analyzed usage data is further processed through a variety of applications in order to generate a response, such as; a report, an alarm, or tailored options for interacting with the generating device which is deliverable in any format within the capacity of the receiving device including all multimedia aspects and non-multimedia aspects. The system further communicates the response in real-time to any device within the set as designated by the subscriber. In another aspect of the invention, the analyzed usage data can be stored for on demand requests of a communication response from past analysis.

Owner:CINGULAR WIRELESS II LLC

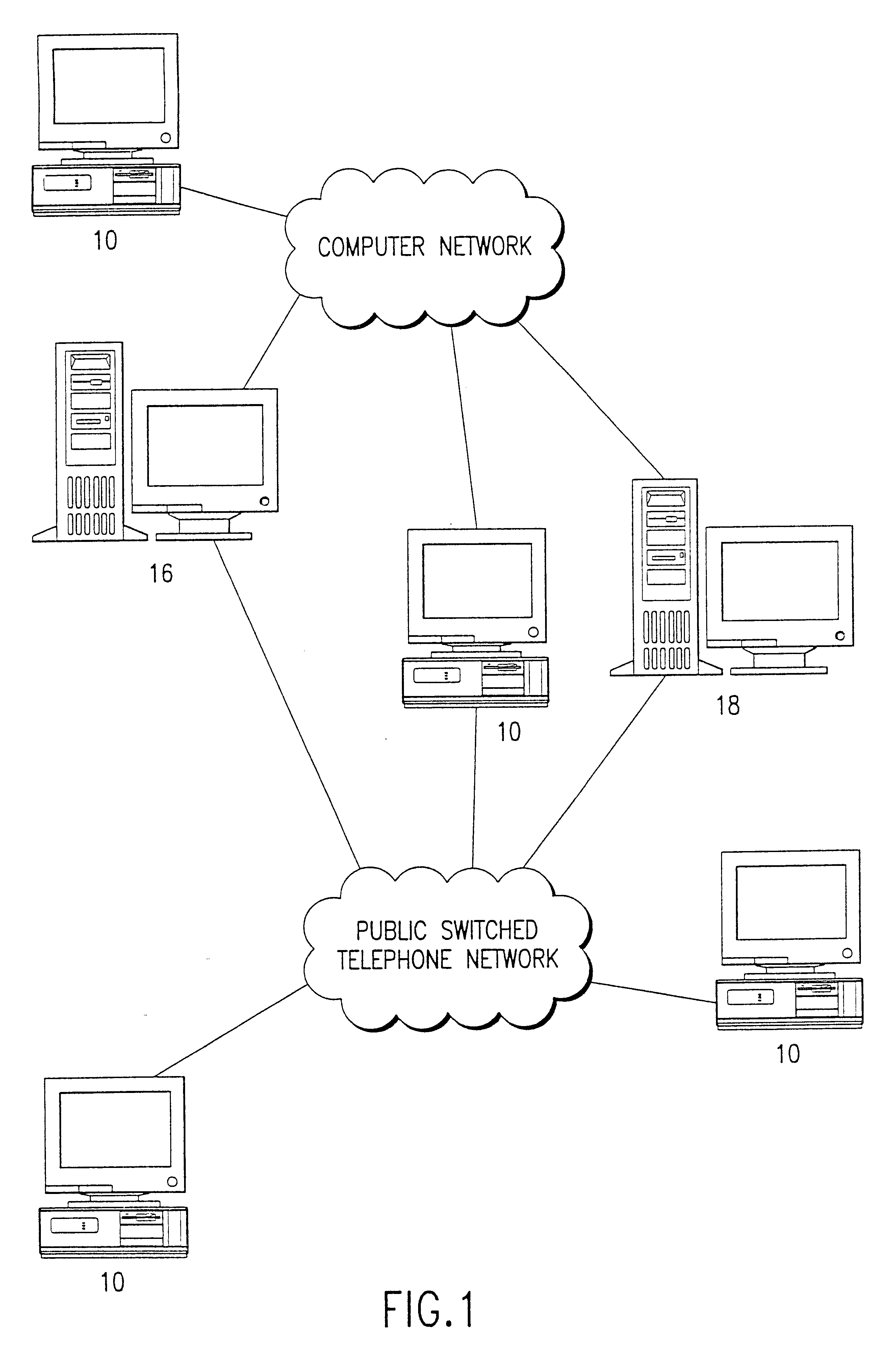

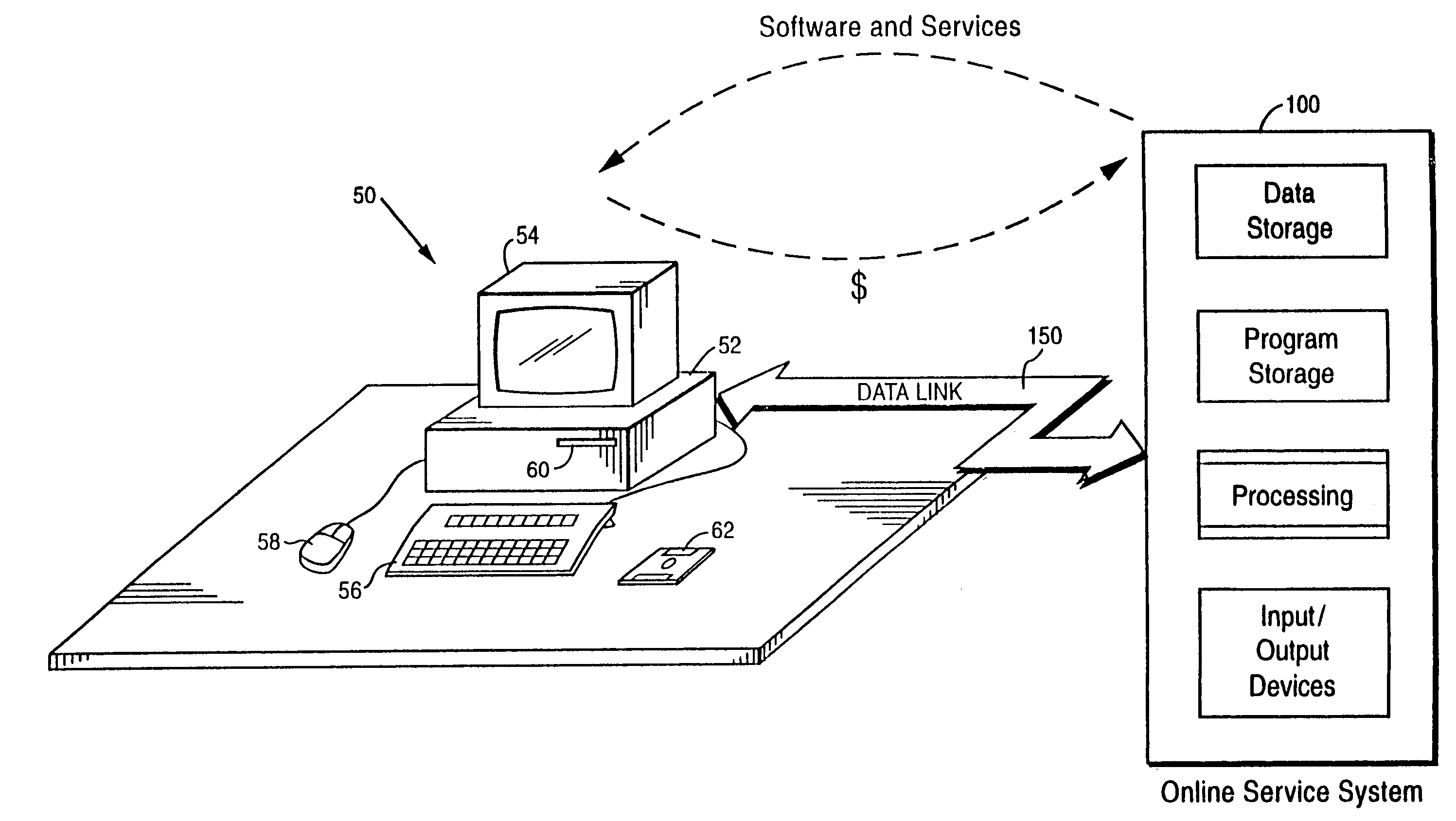

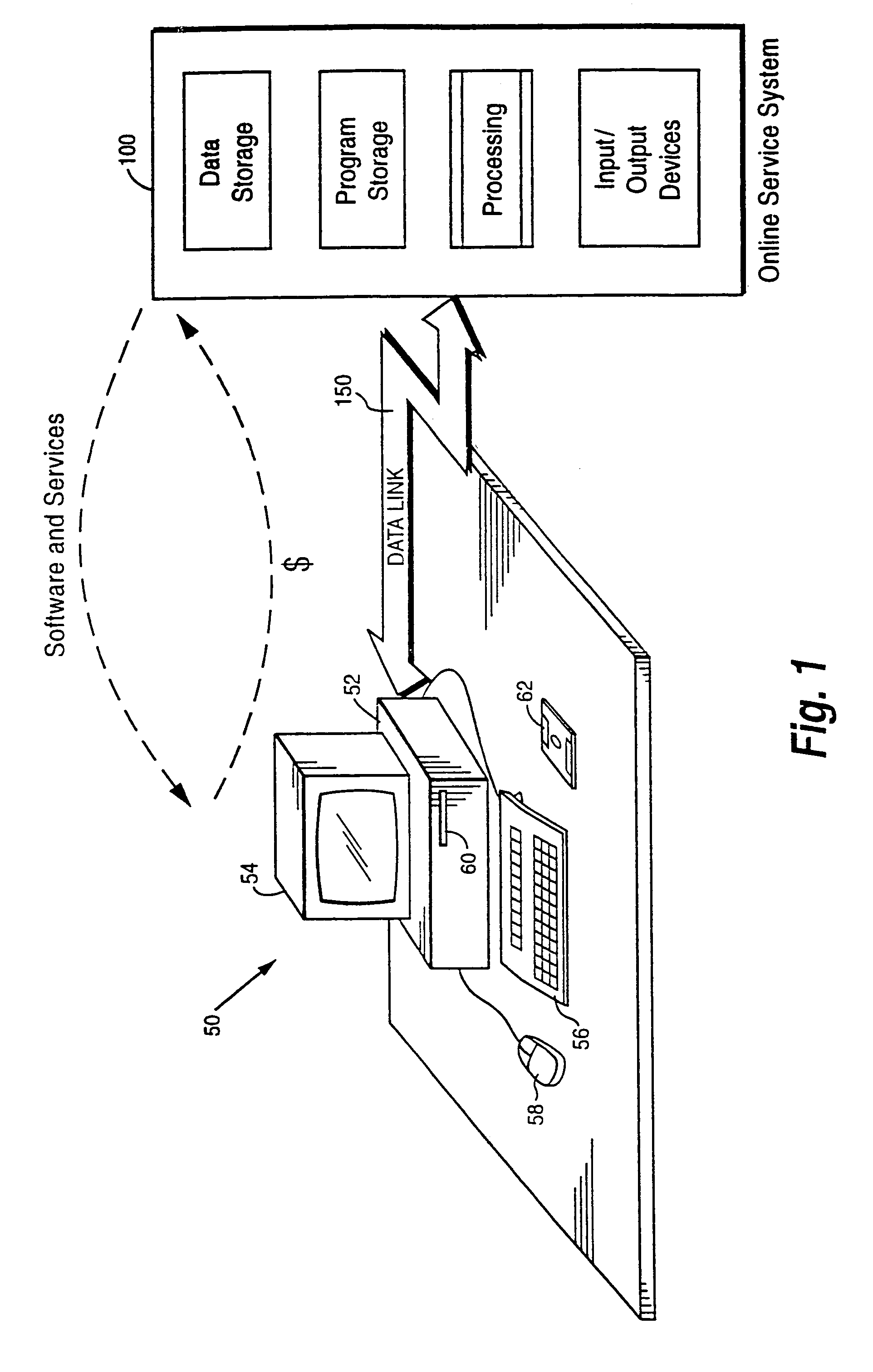

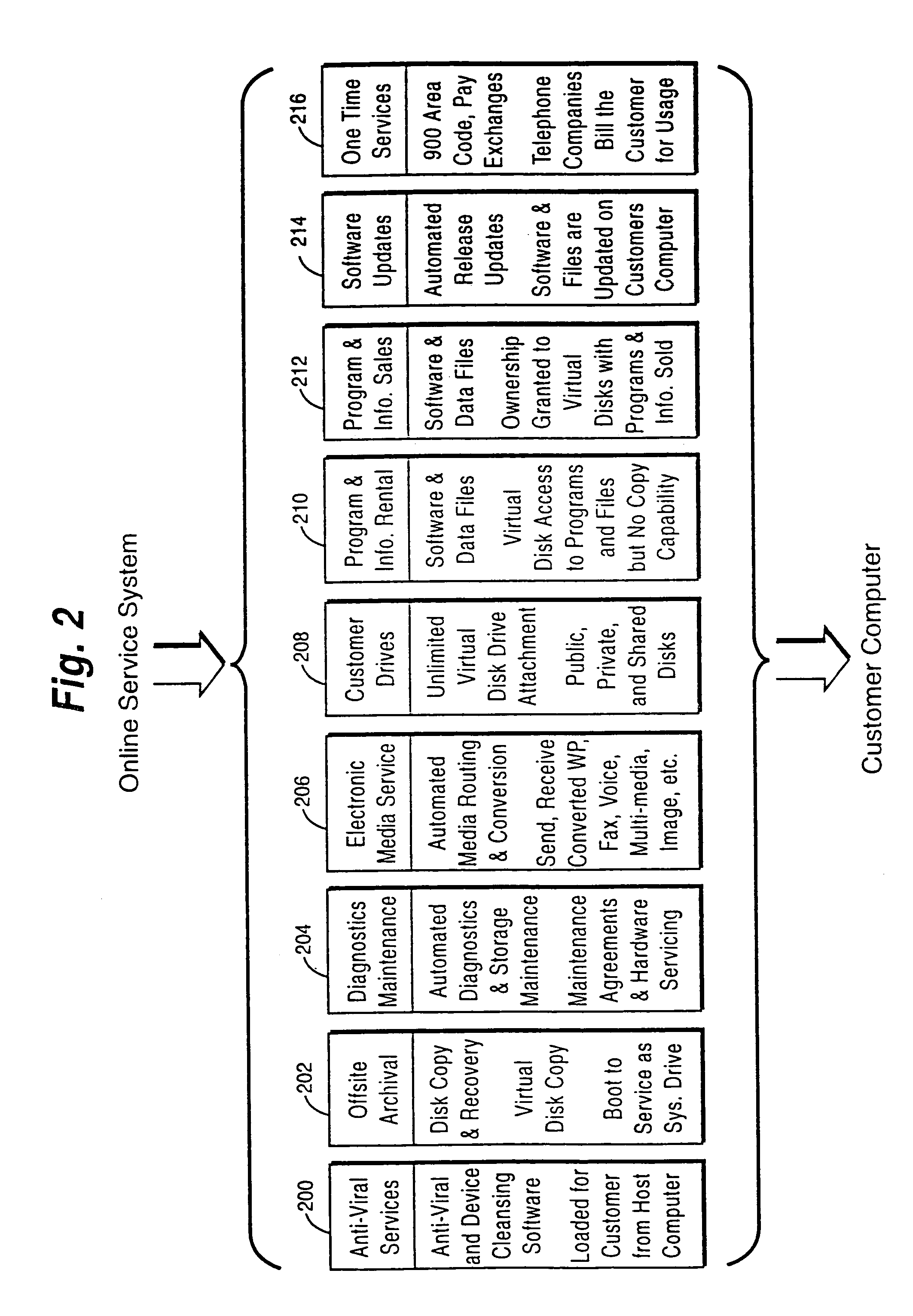

Internet download systems and methods providing software to internet computer users for local execution

A customer computer connects to an online service provider by phone, Internet, or other telecommunications link. The link gives the customer access to additional processing and storage resources such as virtual storage, processing power and / or additional software or data through interaction between the customer computer and an online service provider computer over the link. The additional resources made available to the customer computer enhance the customers' local needs through access to virtual storage, a more powerful processor of similar type for program execution, and / or online support services such as software rental, software sales, release update services, anti-viral services, data backup and recovery services, diagnostic services and / or repair services.

Owner:OASIS RES +6

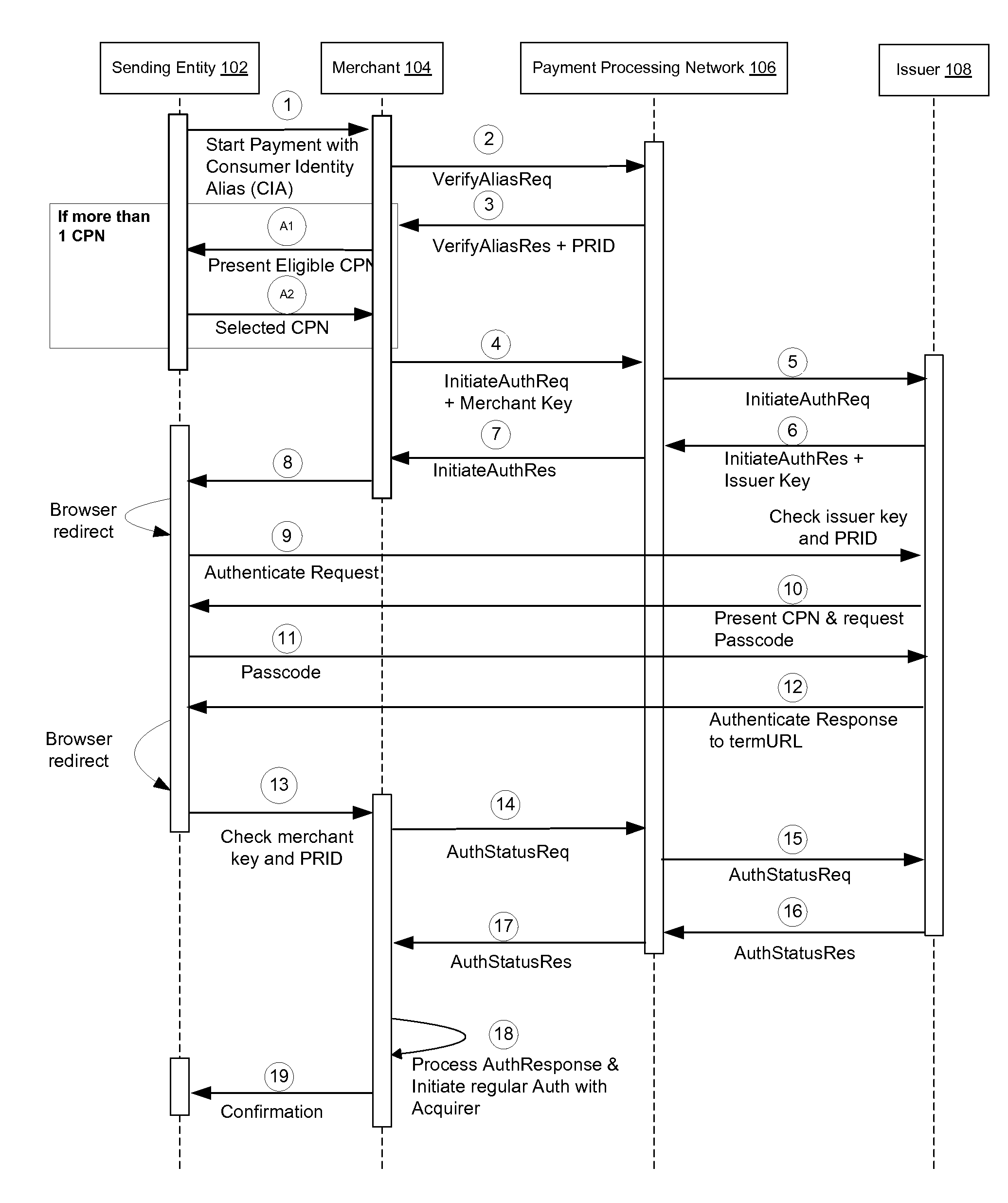

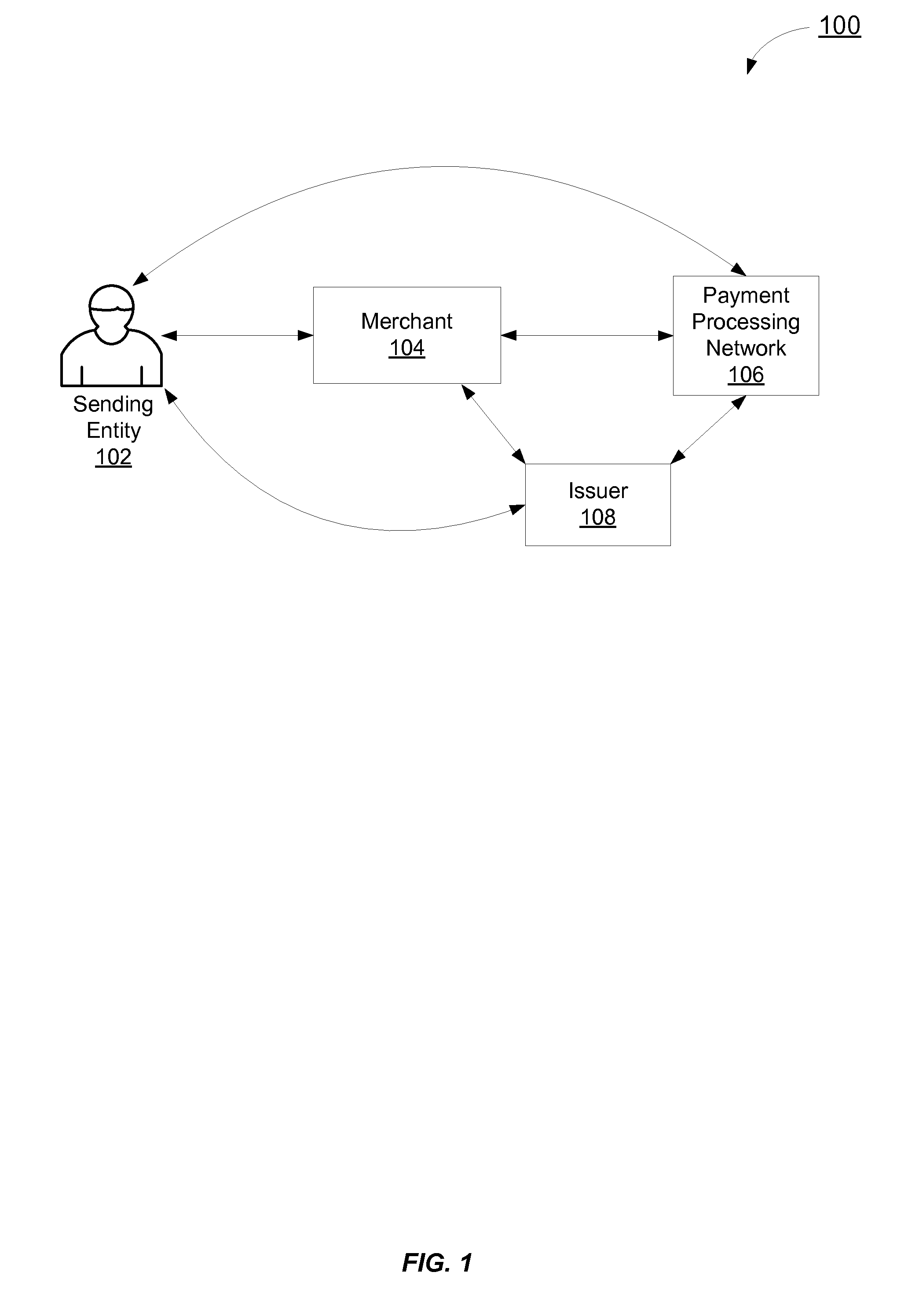

Token based transaction authentication

A token based transaction authentication system is disclosed. Issuer, merchants, and a payment processing network generate unique tokens or keys to authenticate messages between themselves and to authenticate a sending entity or consumer as they are redirected between entities. The tokens are also used to identify the particular authentication thread a message or sending entity is associated with. The sending entity authentication occurs over a web-based channel or a mobile based channel.

Owner:VISA INT SERVICE ASSOC

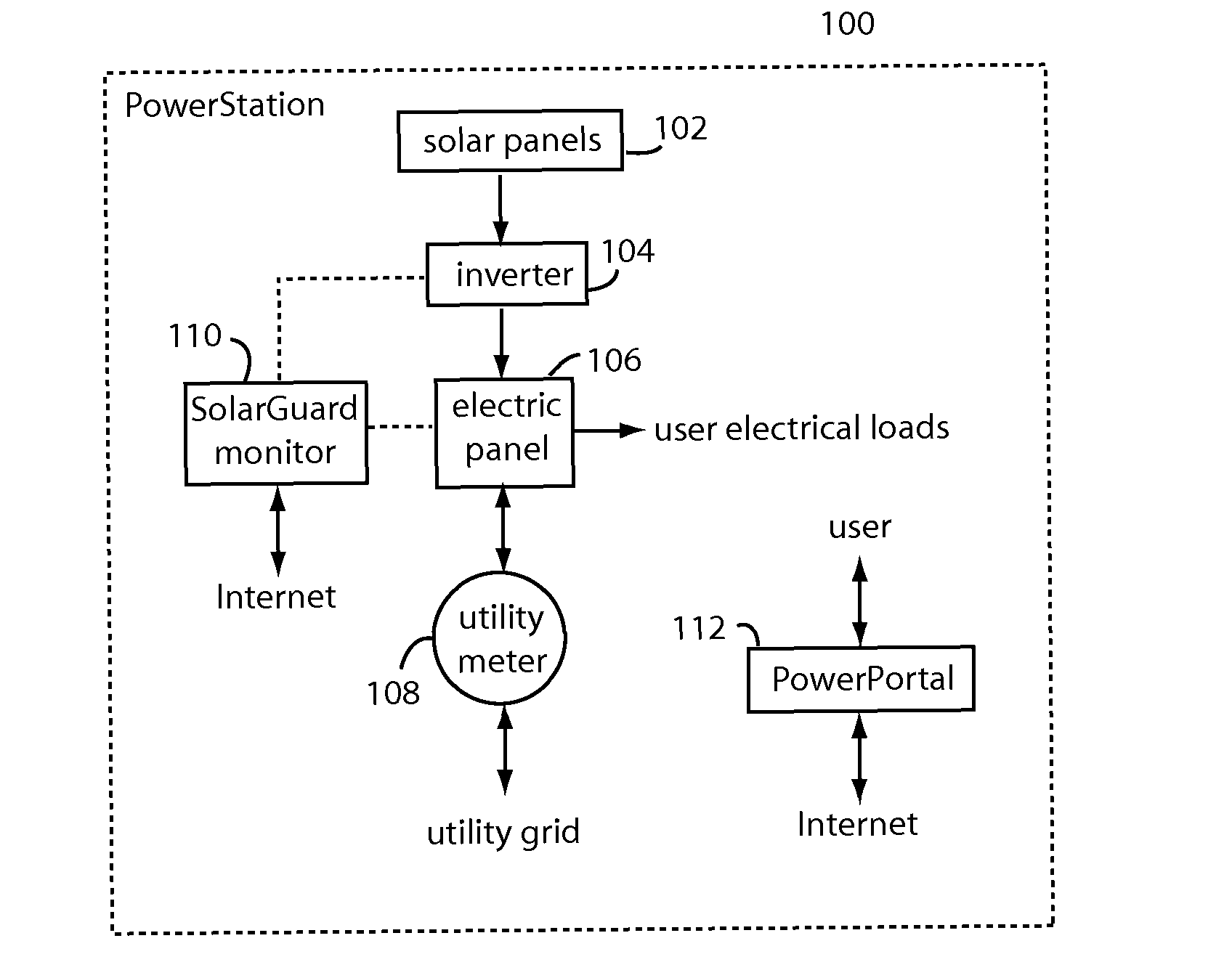

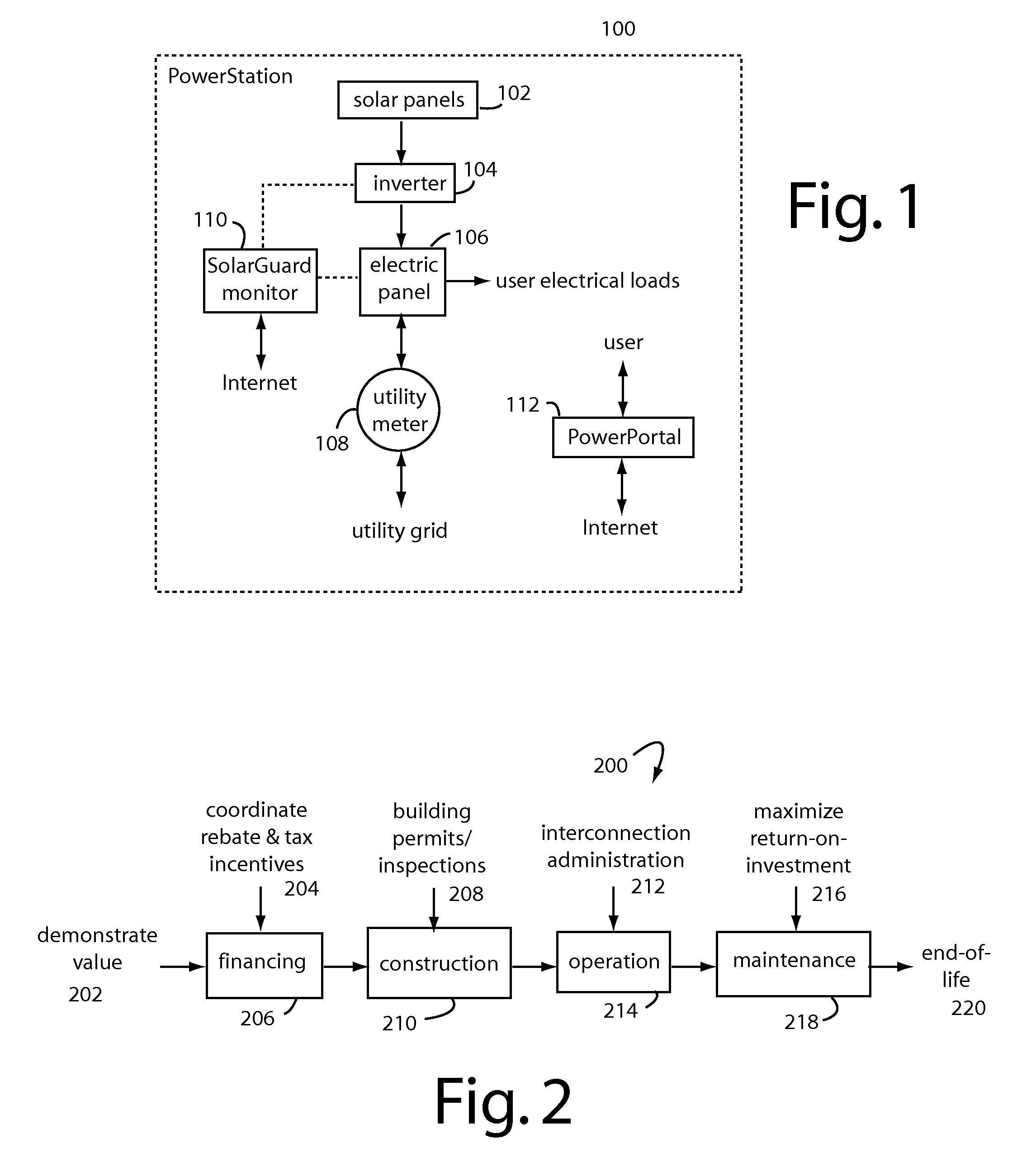

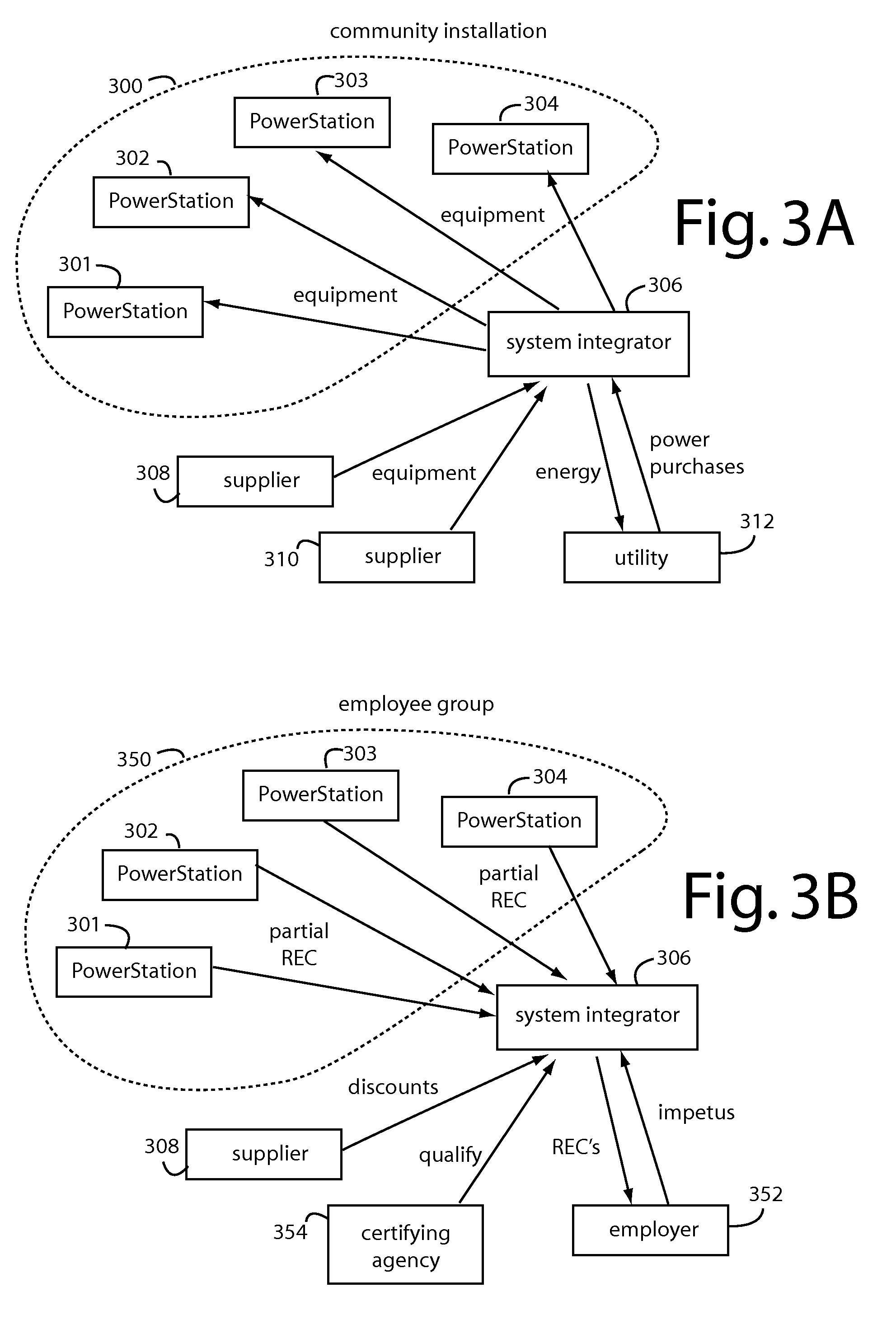

Renewable energy system monitor

ActiveUS7925552B2Complete banking machinesElectric signal transmission systemsPower stationEngineering

Embodiments of the present invention include a renewable energy system monitor. In one embodiment, information is received in a server from solar power stations across a network. The information includes operational data for each solar power station identified by a particular power station identification (ID). The information is stored in a database and grouped data groups corresponding different solar power stations. Data groups are processed using different models associated with different power stations to control the different power stations. Software or parameters may be sent to different devices in the different power stations to control the power stations.

Owner:SOLARCITY

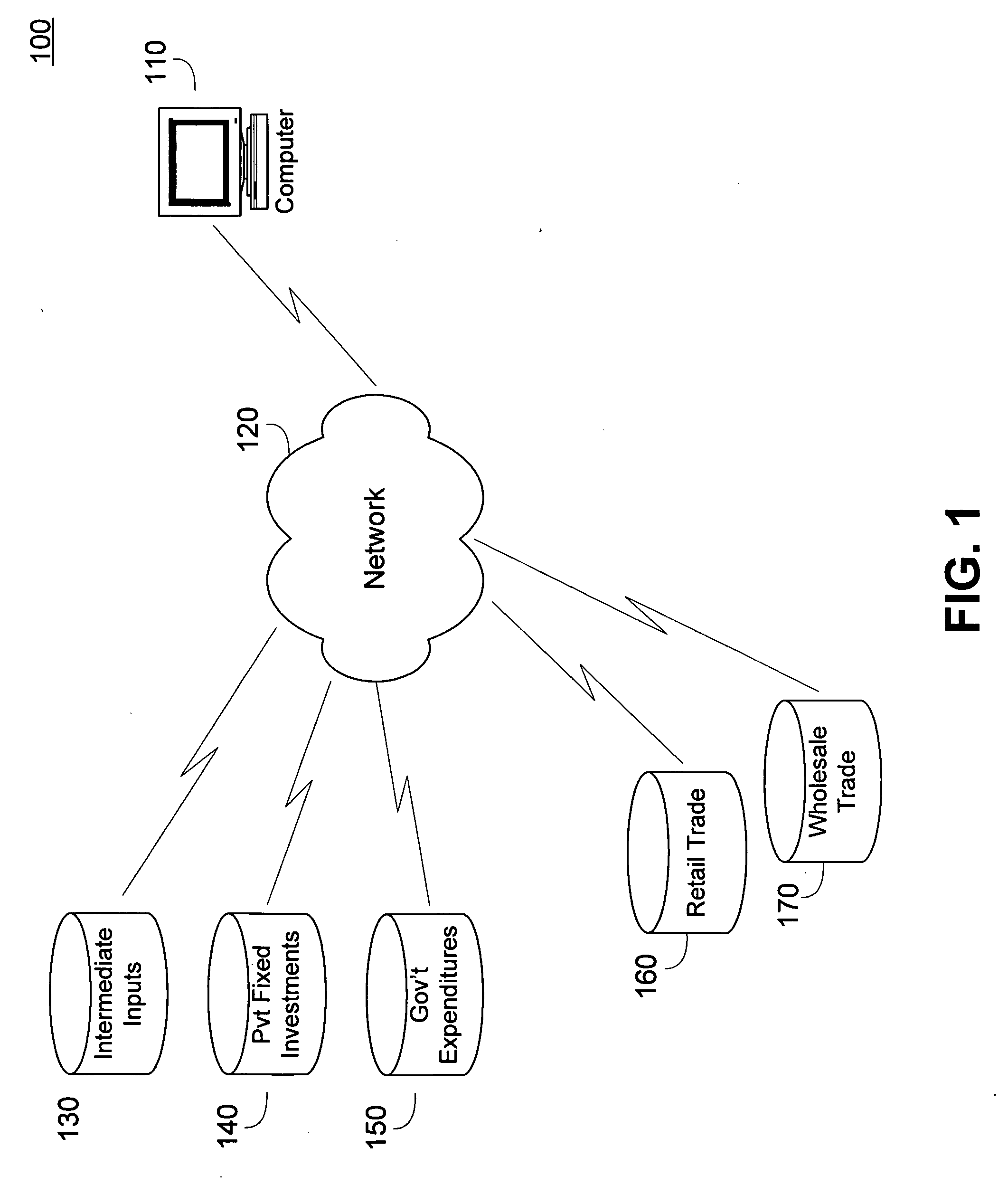

Commercial market determination and forecasting system and method

Methods and apparatus for determining a value of a commercial market that can be supported by an electronic payment solution, forecasting a growth of the commercial market, and using the commercial expenditure value are disclosed. The value of the commercial market can be estimated using auditable economic data that forms part of a Gross Domestic Product (GDP) calculation. The commercial market can be estimated using intermediate inputs, inventory purchase, private fixed investments, and government expenditures. A market growth can then be estimated from the commercial expenditure value and other economic data. The commercial expenditure value can be used in a number of resource allocation and market solution processes.

Owner:VISA USA INC (US)

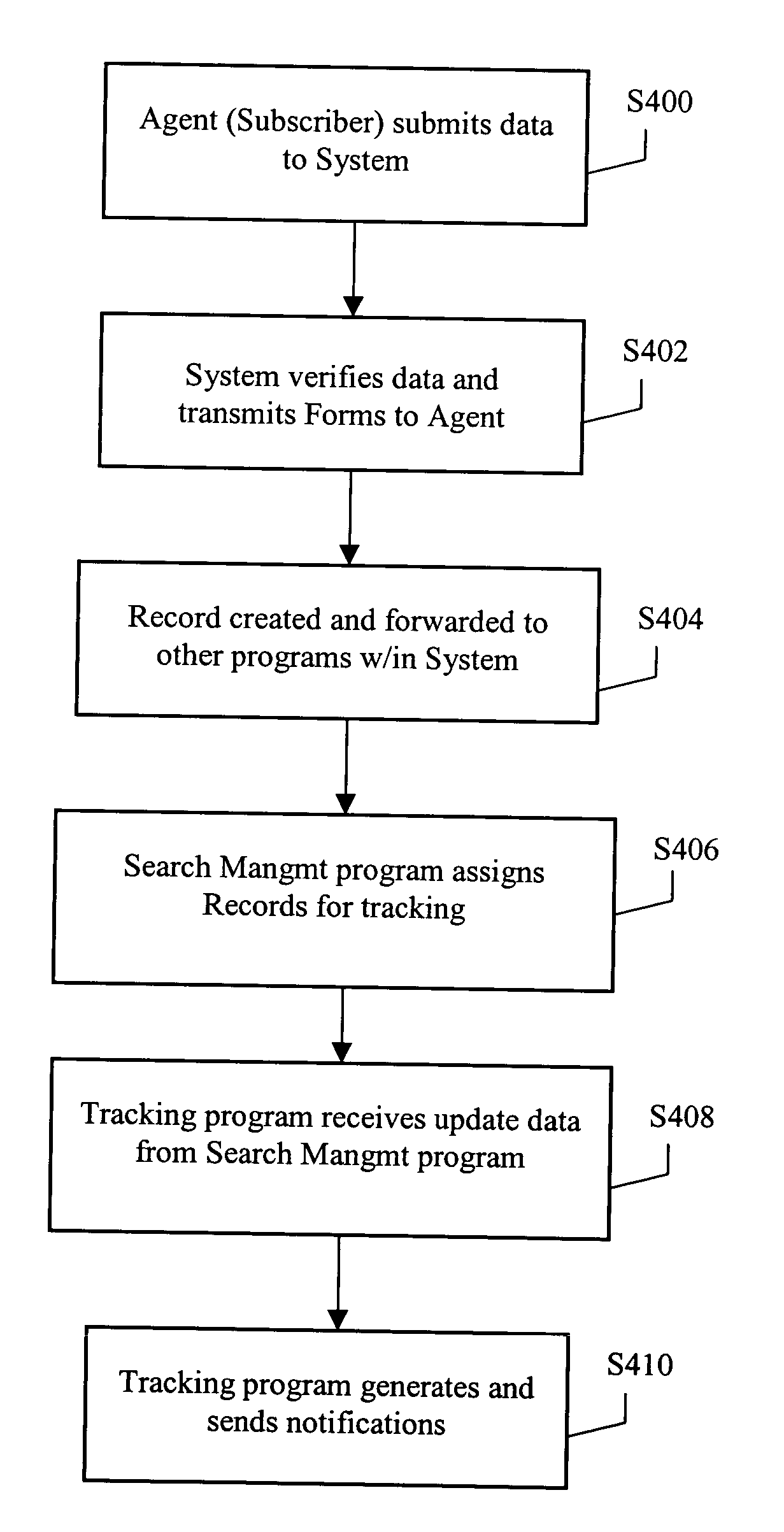

System and method for automated release tracking

A real estate transaction and release tracking system ensures deeds of trust, liens and other encumbrances are released in a timely manner after a specified (or statutory) period of time following settlement of a real estate transaction. Based on information provided by an agent, such as an escrow agent or a settlement agent, the system creates a unique electronic record for each real estate transaction entered by the agent. The system tracks lien status information, either automatically from other computers or via manual input from searchers, and uses this status information to track each real estate transaction. The system monitors the records and indicates when a lien holder has failed to release their lien after a statutory time period that begins after the passing of the settlement date. When the statutory time period has passed, the system can generate a number of forms, including a demand letter as controlled optionally by the system or the user. The demand letter can be sent to the lien holder demanding them to release the lien. If the lien is not thereafter released, further legal documents can be generated and sent to a law firm or enforcement agent for legal action to be taken against the delinquent lien holder.

Owner:REQUIRE HLDG LLC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com