Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

157results about How to "Minimize fluctuation" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

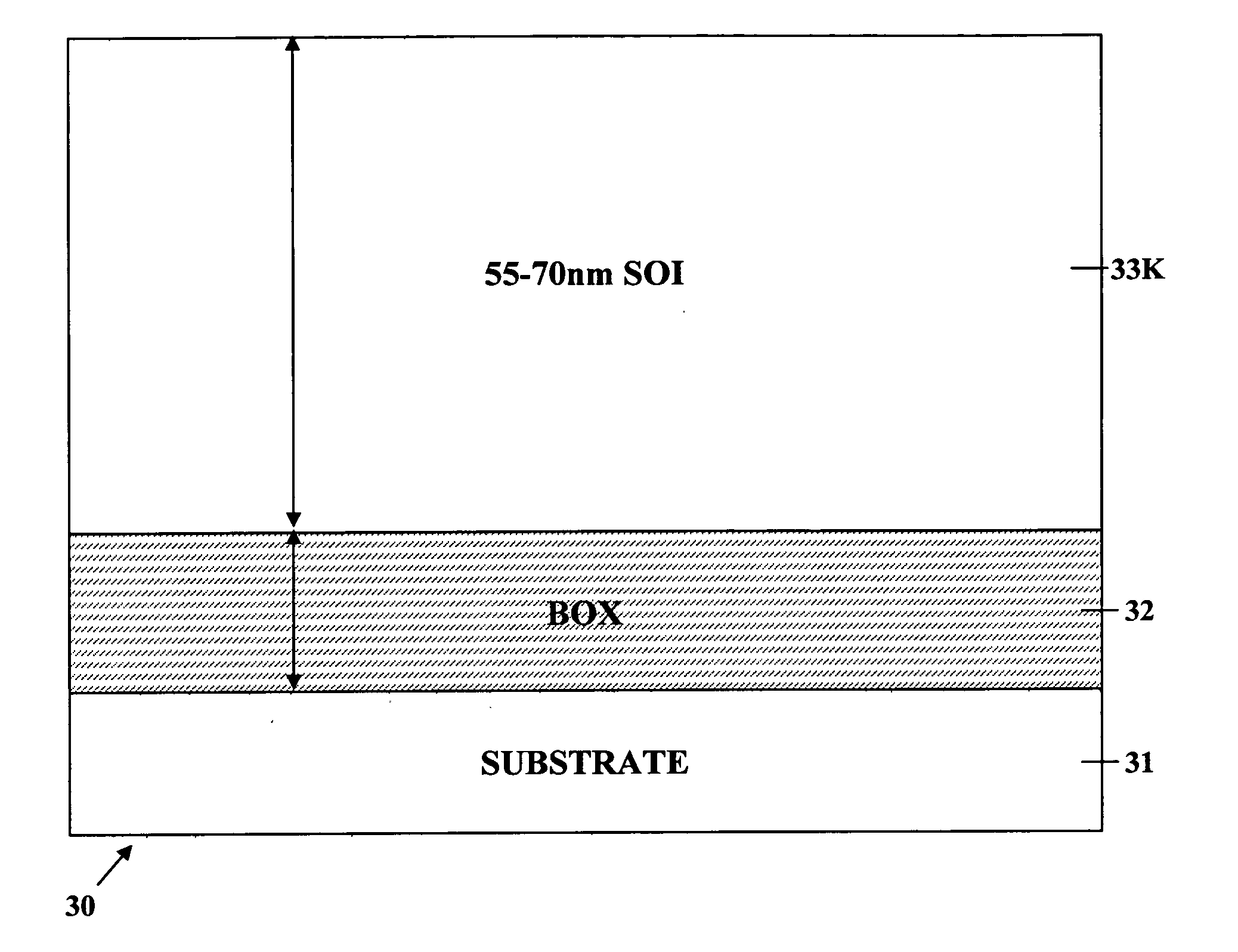

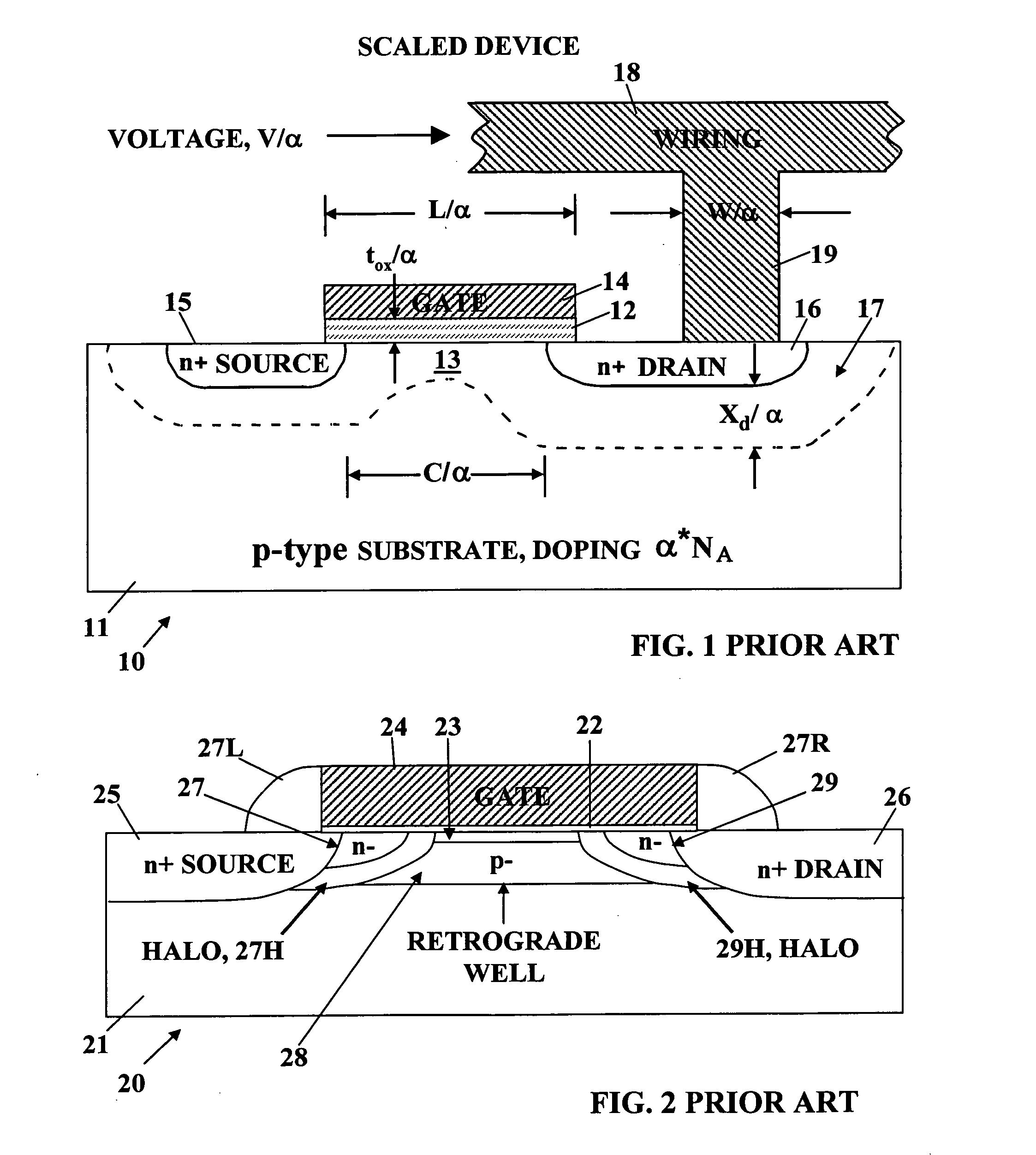

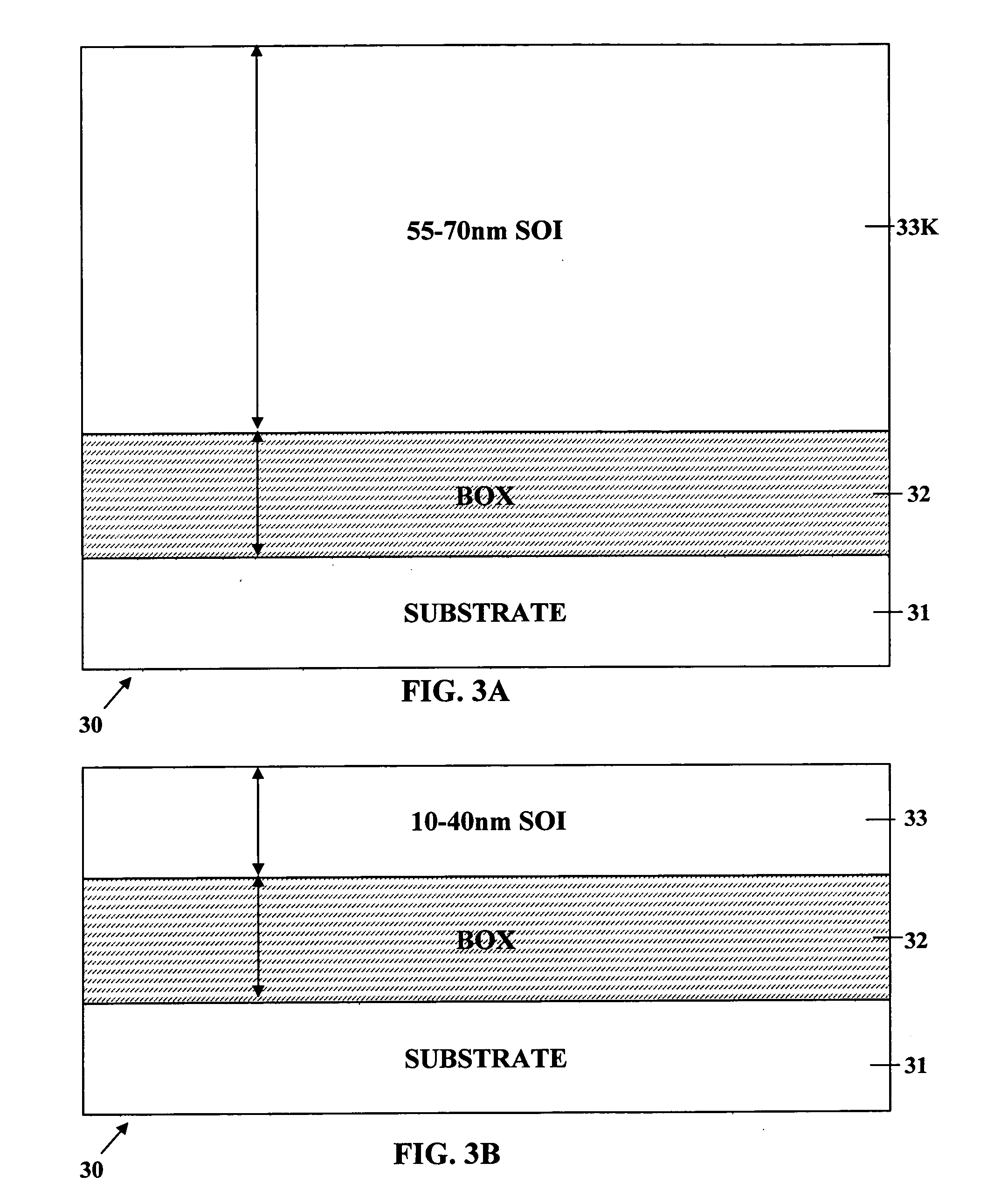

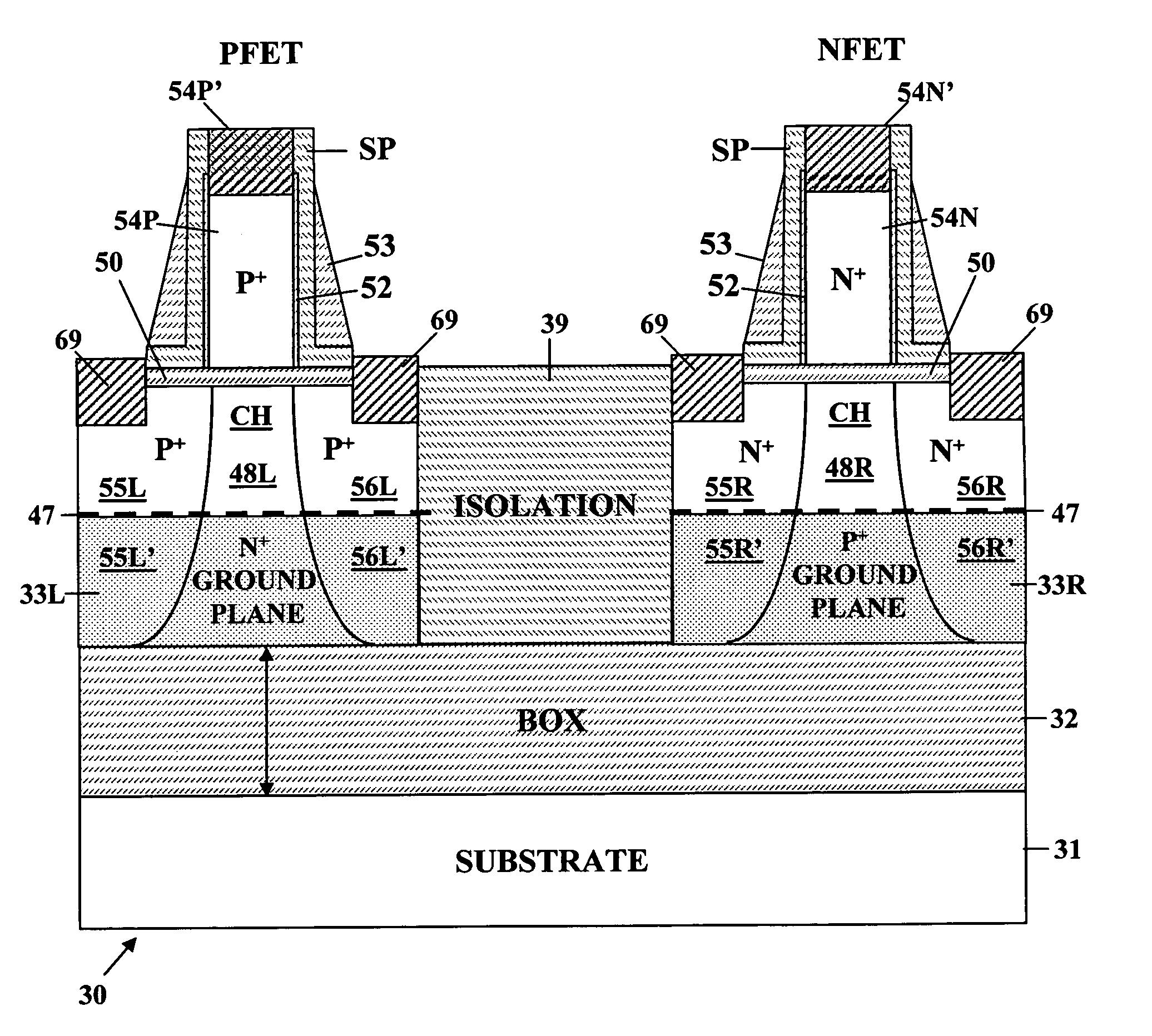

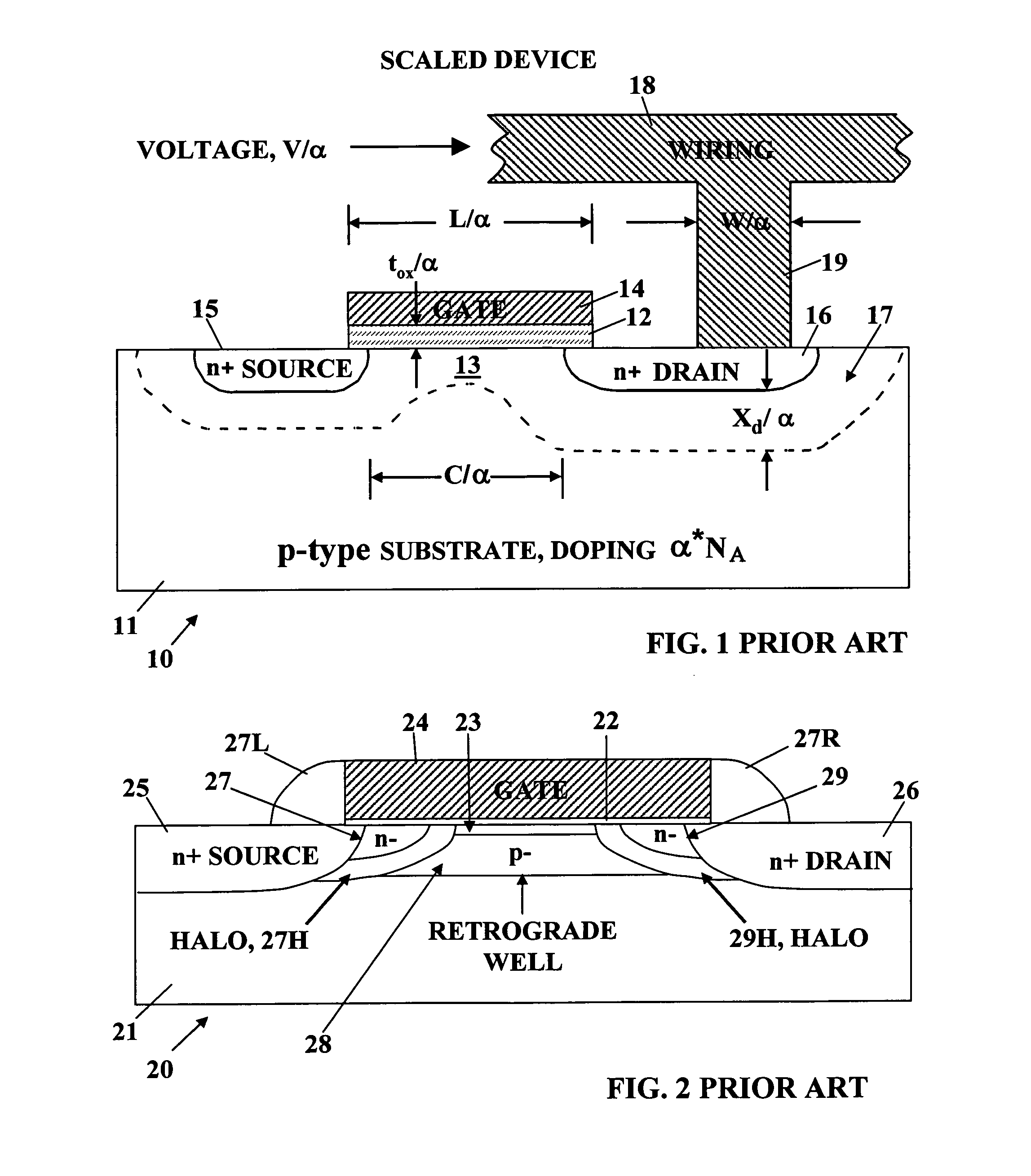

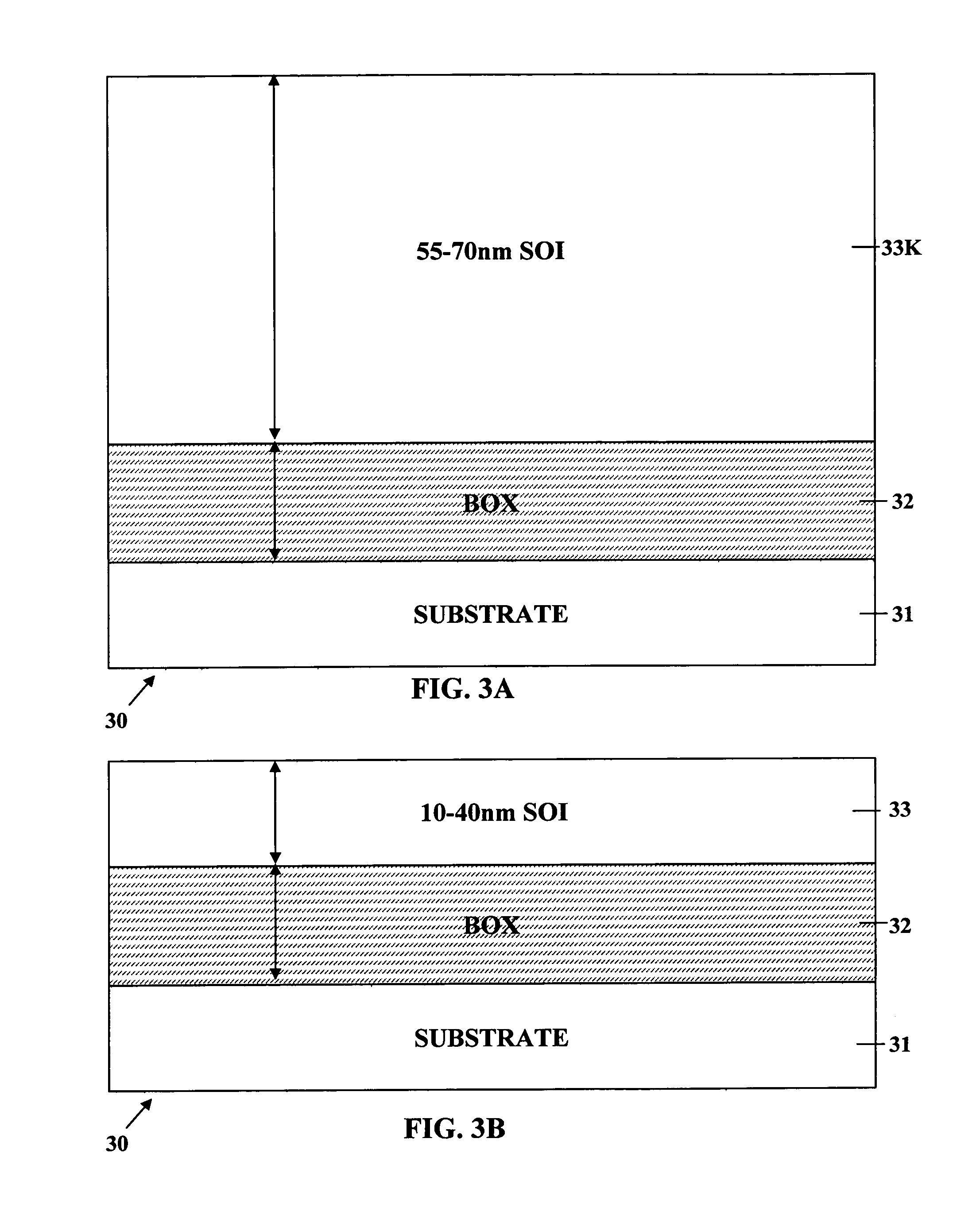

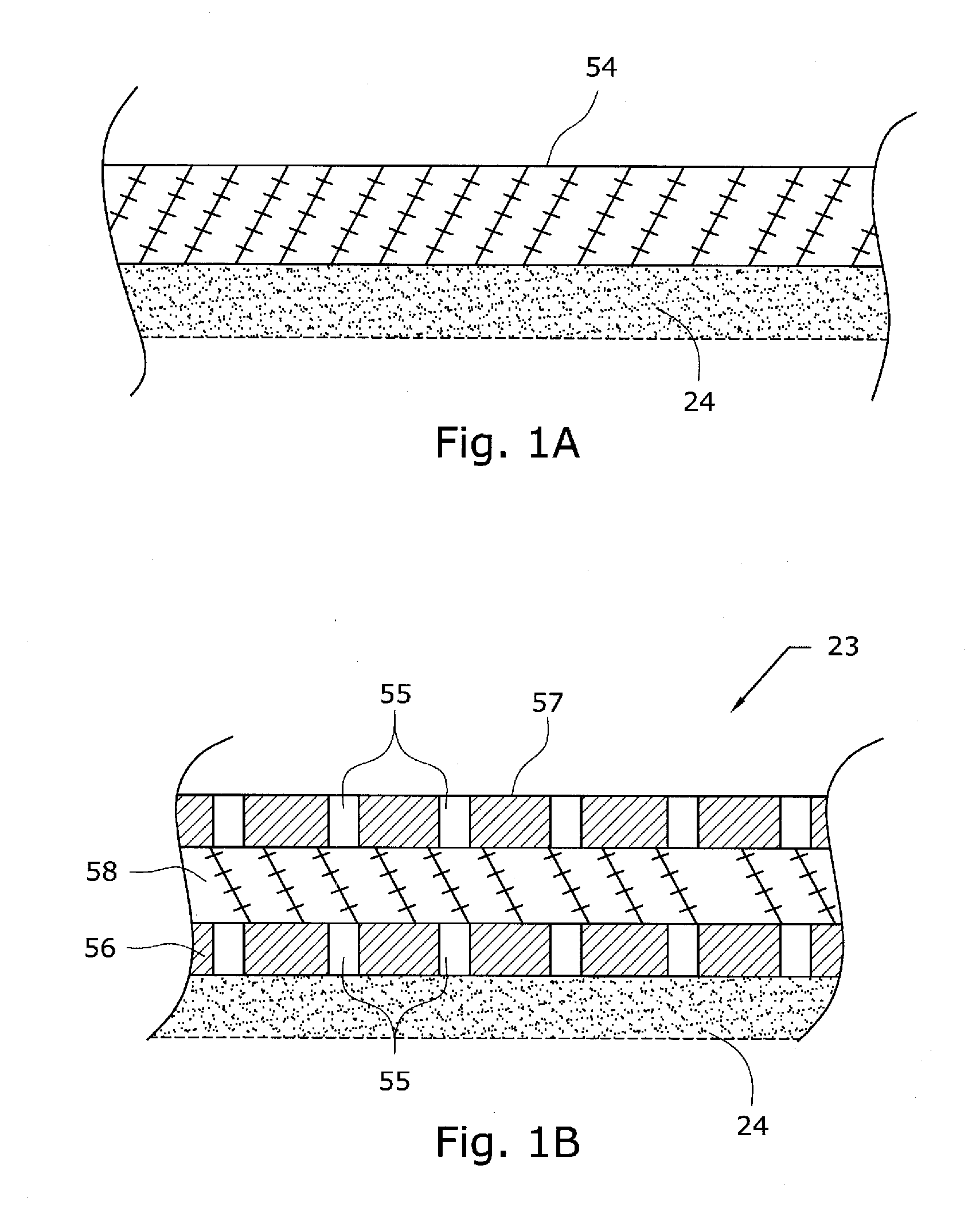

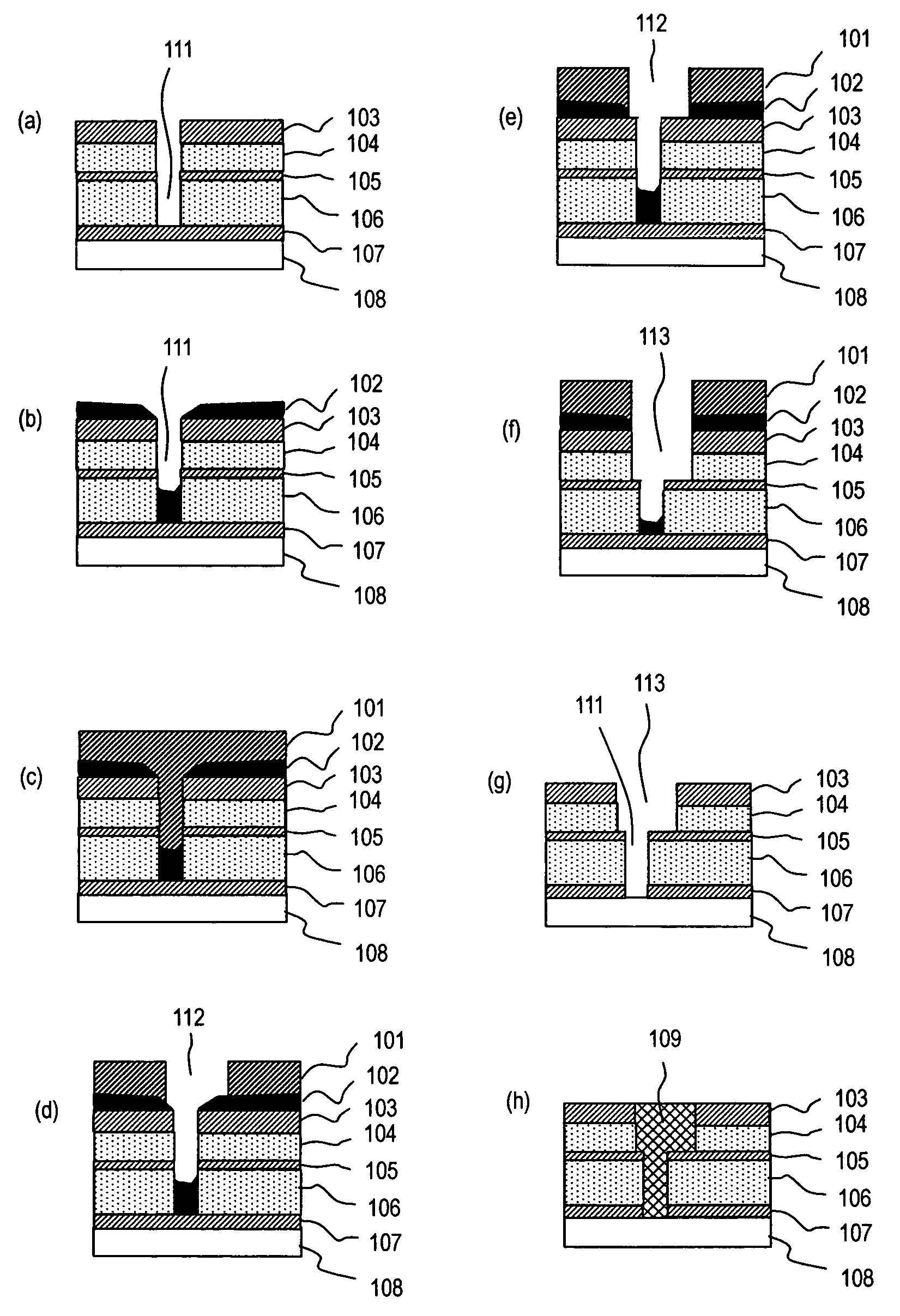

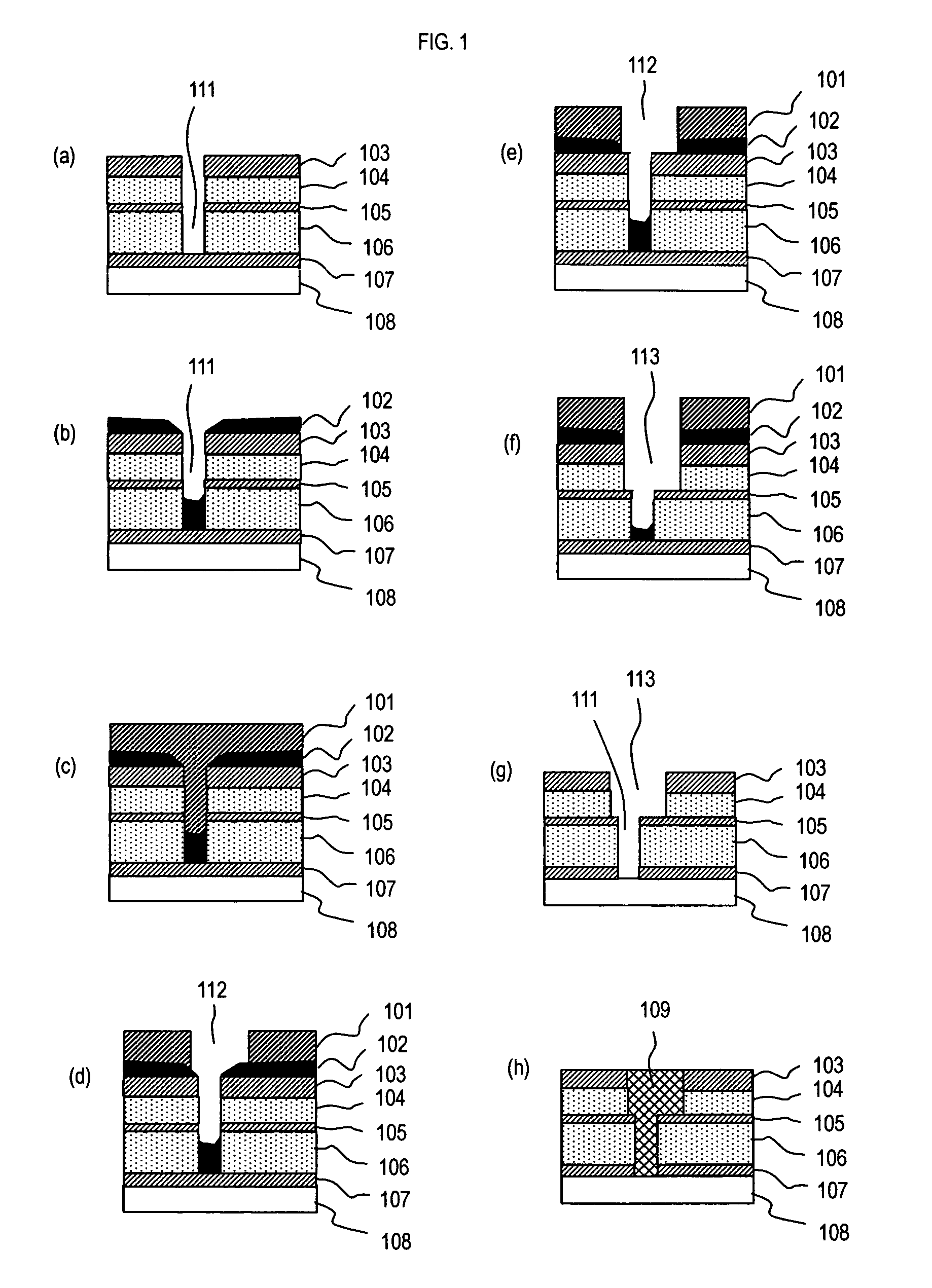

Ultra-thin body super-steep retrograde well (SSRW) FET devices

ActiveUS20060022270A1Minimize space-charge related fluctuationReduce capacitanceSolid-state devicesSemiconductor/solid-state device manufacturingDopantGround plane

A method of manufacture of a Super Steep Retrograde Well Field Effect Transistor device starts with an SOI layer formed on a substrate, e.g. a buried oxide layer. Thin the SOI layer to form an ultra-thin SOI layer. Form an isolation trench separating the SOI layer into N and P ground plane regions. Dope the N and P ground plane regions formed from the SOI layer with high levels of N-type and P-type dopant. Form semiconductor channel regions above the N and P ground plane regions. Form FET source and drain regions and gate electrode stacks above the channel regions. Optionally form a diffusion retarding layer between the SOI ground plane regions and the channel regions.

Owner:GLOBALFOUNDRIES US INC

Ultra-thin body super-steep retrograde well (SSRW) FET devices

ActiveUS7002214B1Reduce capacitanceReduce junctionSolid-state devicesSemiconductor/solid-state device manufacturingDopantGround plane

A method of manufacture of a Super Steep Retrograde Well Field Effect Transistor device starts with an SOI layer formed on a substrate, e.g. a buried oxide layer. Thin the SOI layer to form an ultra-thin SOI layer. Form an isolation trench separating the SOI layer into N and P ground plane regions. Dope the N and P ground plane regions formed from the SOI layer with high levels of N-type and P-type dopant. Form semiconductor channel regions above the N and P ground plane regions. Form FET source and drain regions and gate electrode stacks above the channel regions. Optionally form a diffusion retarding layer between the SOI ground plane regions and the channel regions.

Owner:GLOBALFOUNDRIES US INC

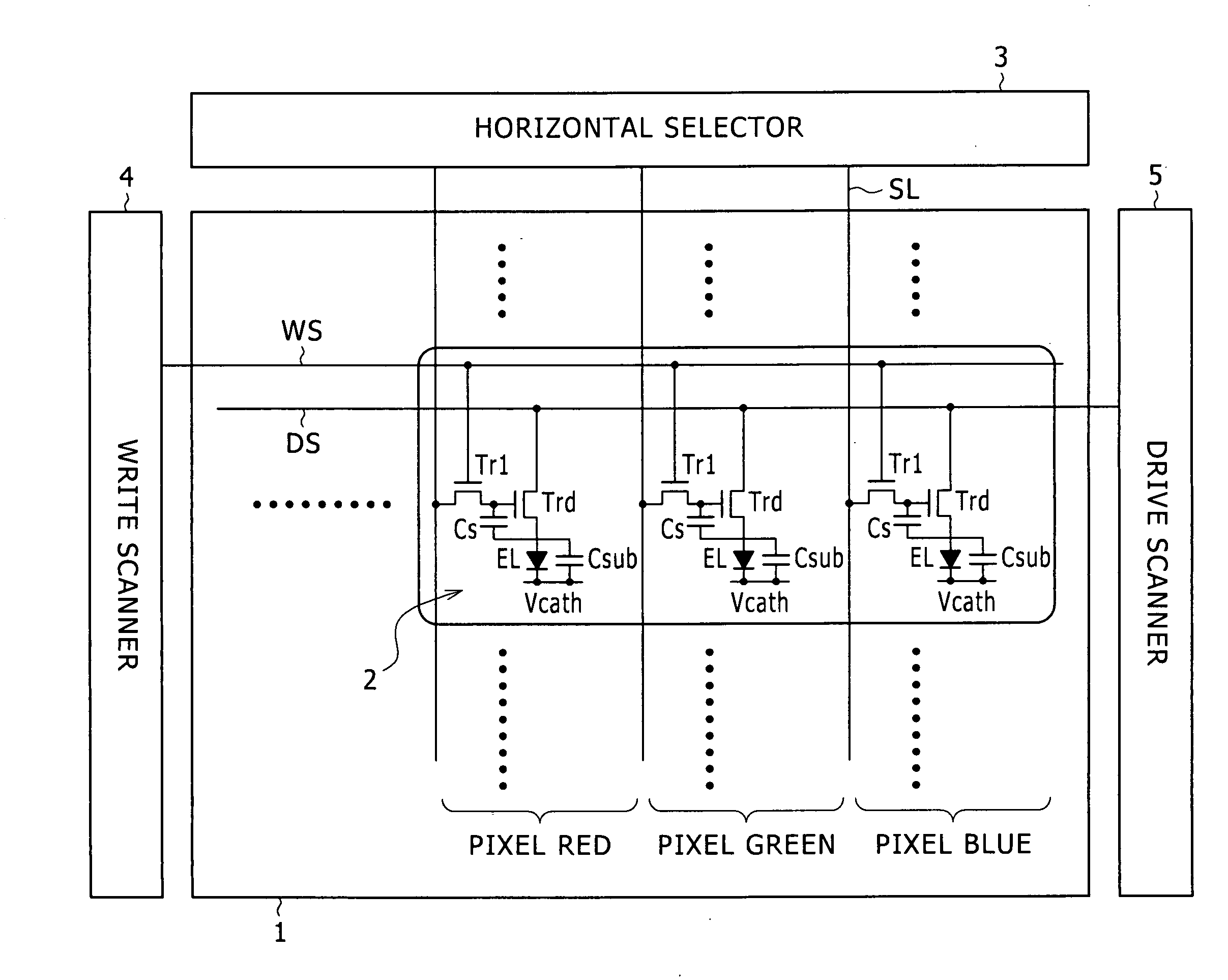

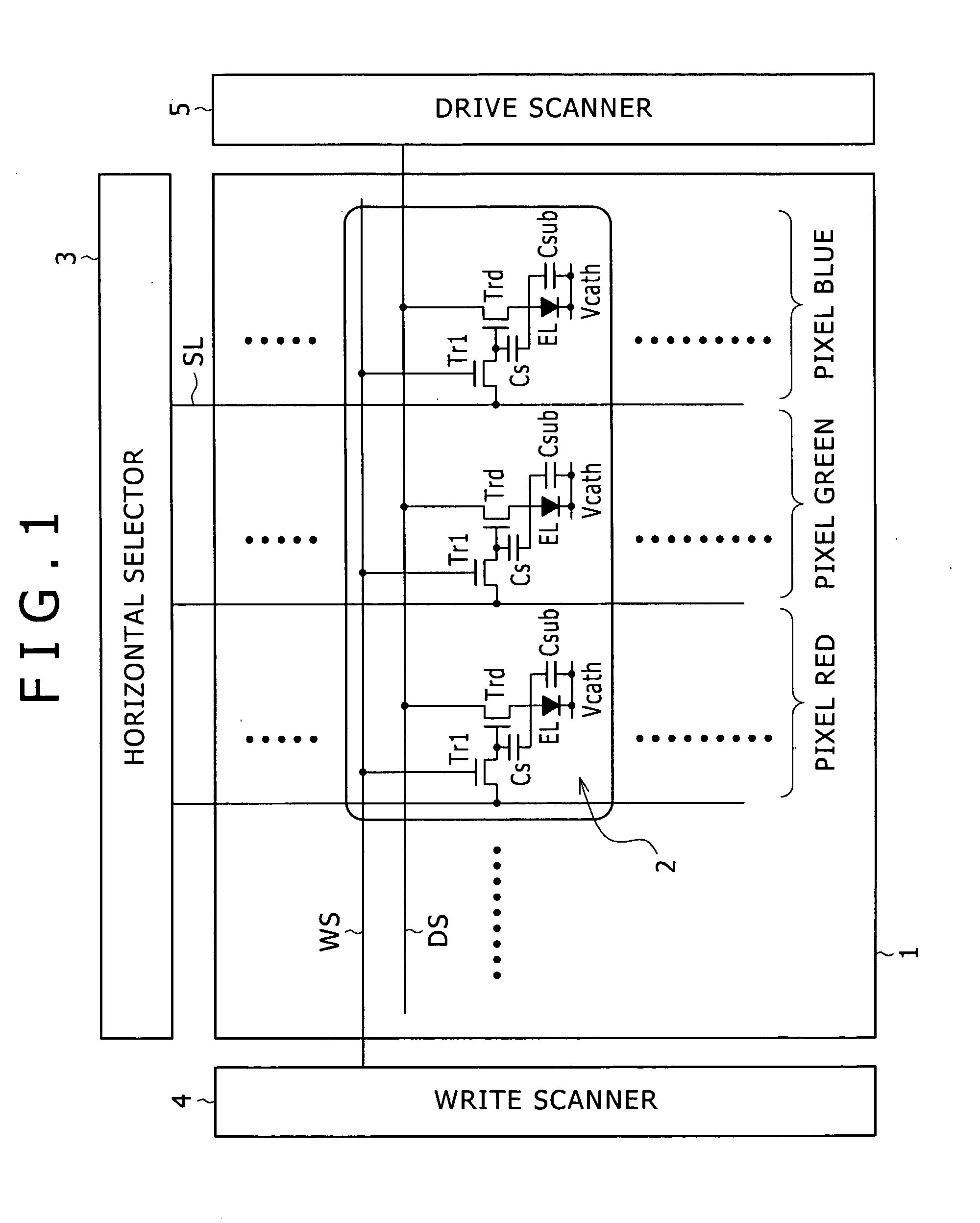

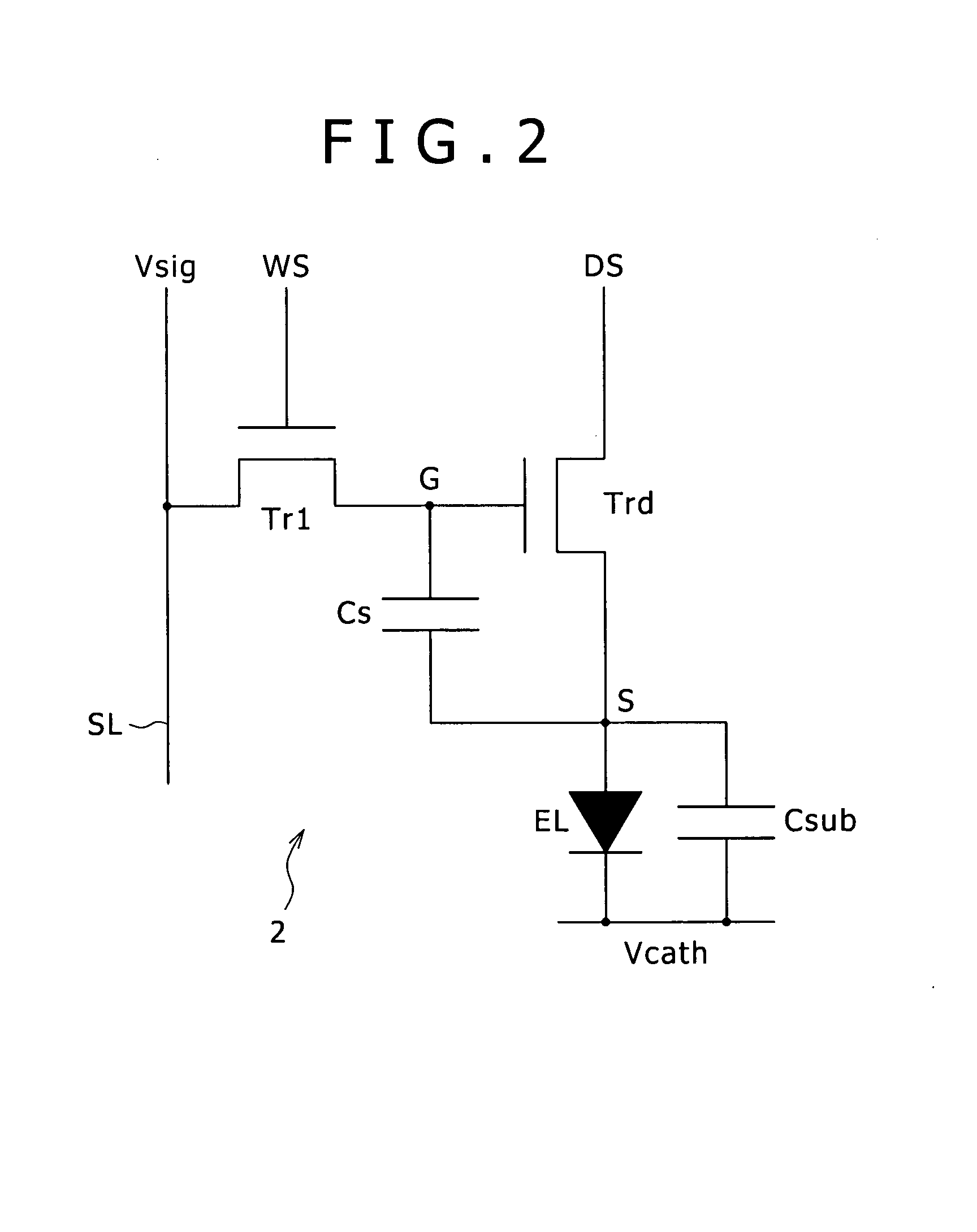

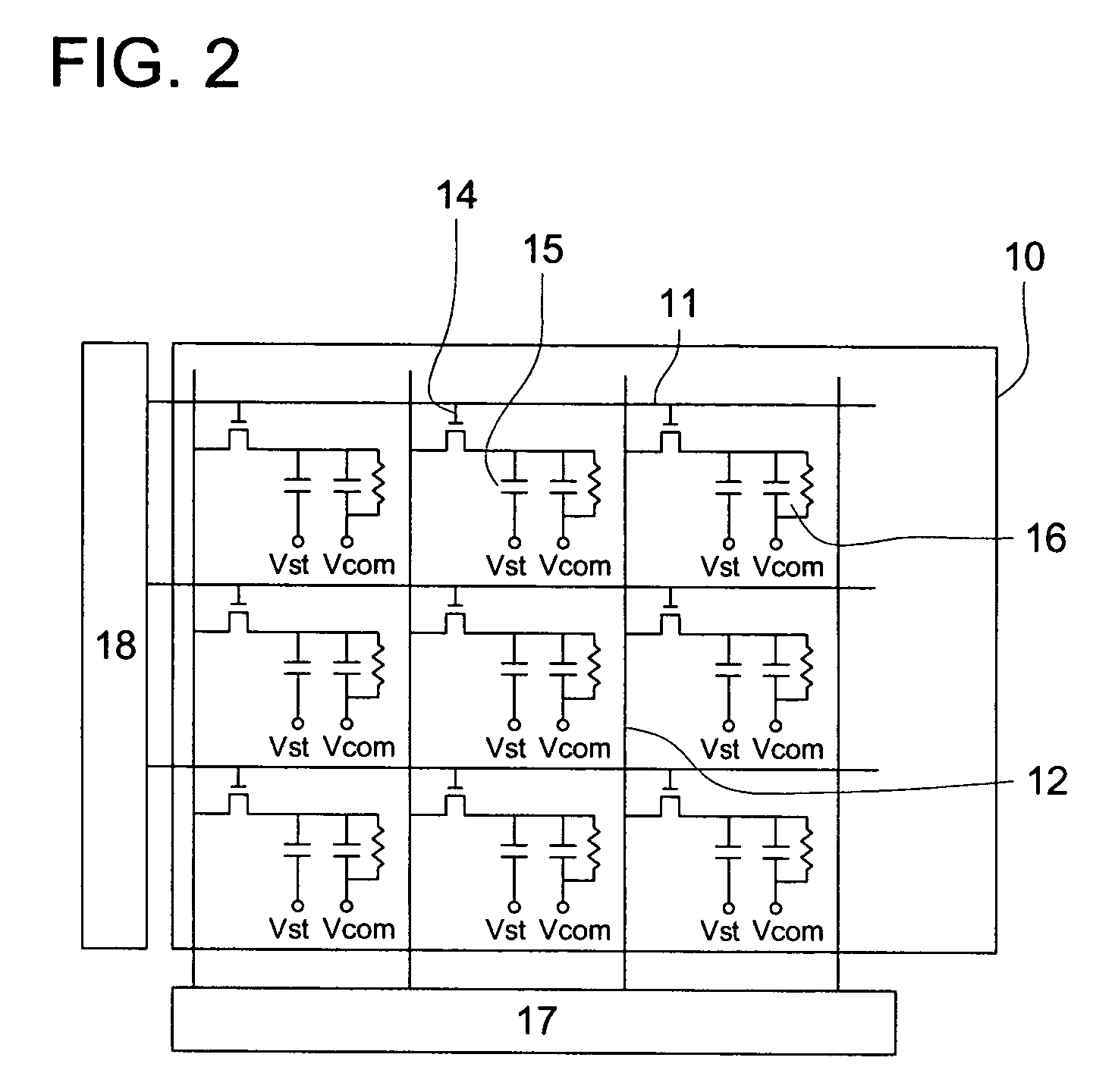

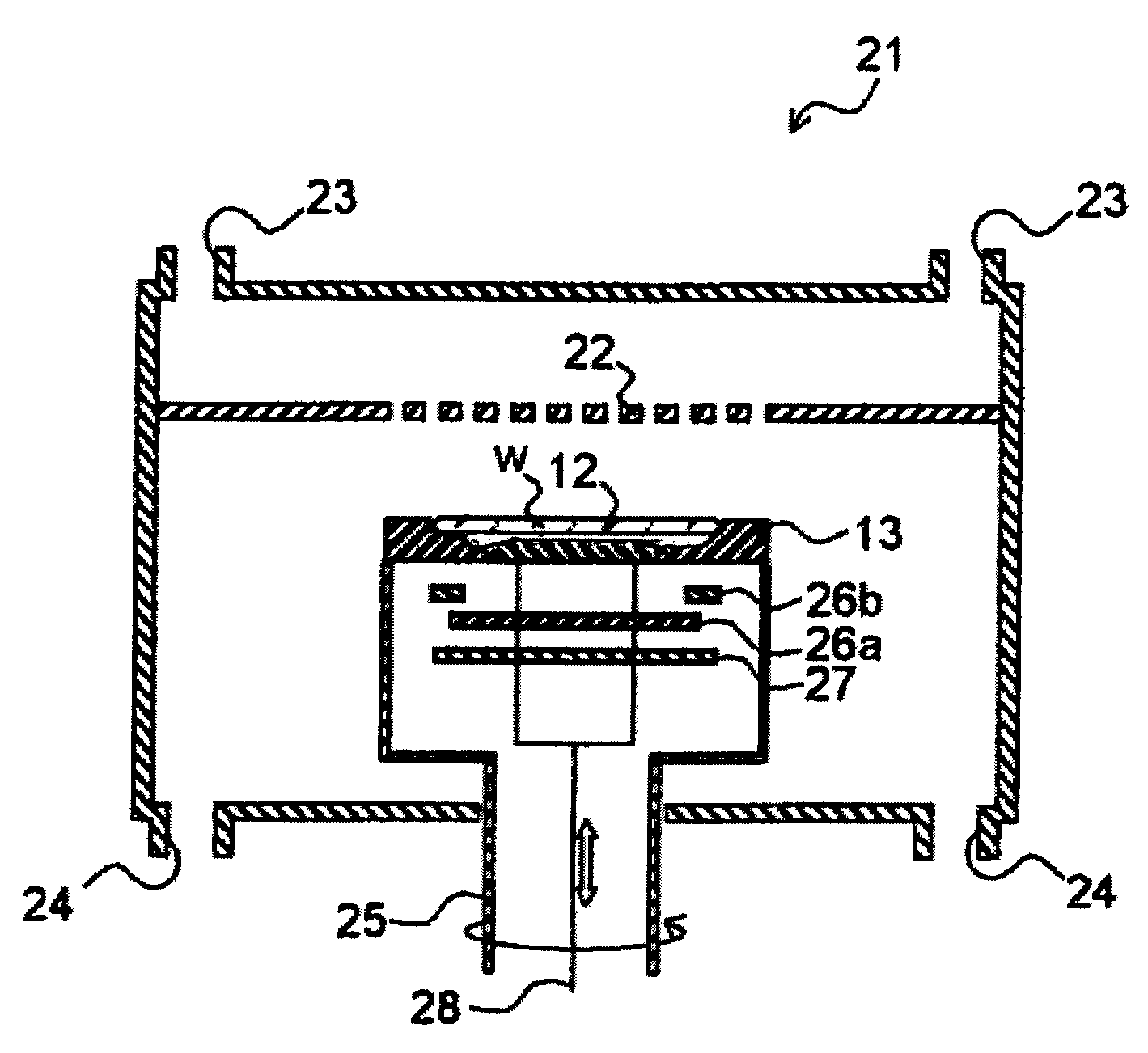

Display apparatus and drive method thereof and electronic device

InactiveUS20080231625A1Small fluctuationQuality improvementElectrical apparatusElectroluminescent light sourcesControl signalScan line

Disclosed herein is a display apparatus including a pixel array section and a drive section. The pixel array section has power supply lines, scan lines arranged in row, signal lines arranged in column, and pixels arranged in matrix at intersections of each of the scan lines and each of the signal lines. The drive transistor is connected at one of a pair of current terminals to the light emitting device and at the other of the pair of current terminals to the power supply line. The drive section supplies a control signal to each scan line and a video signal to each signal line to drive each pixel, executing a threshold voltage correcting operation, a write operation, and a light emitting operation.

Owner:JOLED INC

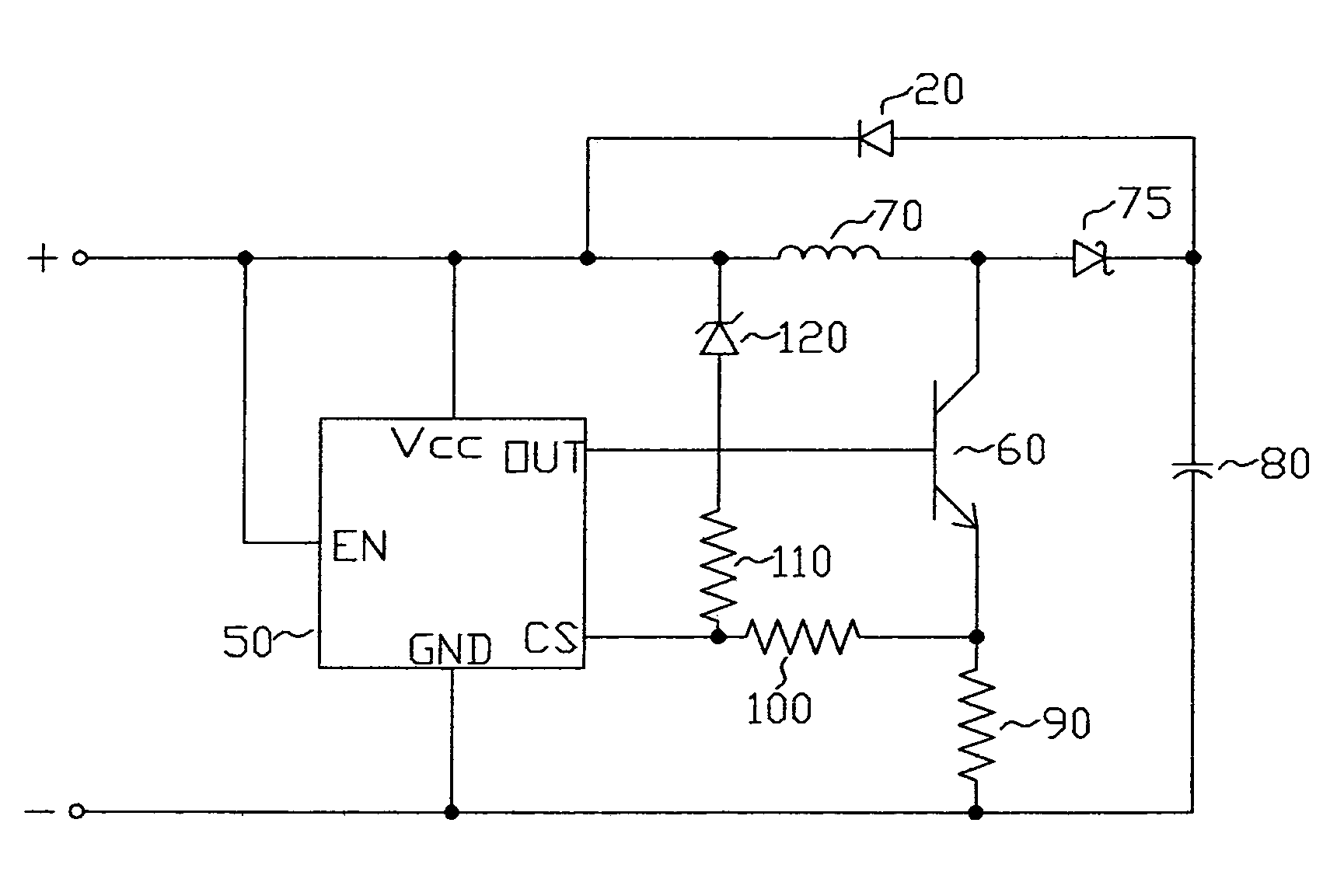

Circuit devices, circuit devices which include light emitting diodes, assemblies which include such circuit devices, flashlights which include such assemblies, and methods for directly replacing flashlight bulbs

ActiveUS7015650B2Increases percentage of useful powerExtend your lifePoint-like light sourceElectroluminescent light sourcesElectricityElectrical connection

A circuit device for providing energy to at least one electrical component, such as a light emitting diode (LED). The circuit device comprises a positive contact, an inductor, a diode and a negative contact in series. A first component contact for electrical connection to a cathode end of an electrical component, a second component contact for electrical connection to an anode end of an electrical component, a switch and a control device are also included. The first component contact is electrically connected to a junction between the positive contact and one end of the inductor; and the second component contact is electrically connected to a cathode end of the diode. There are also provided a circuit device further including an LED, an assembly including a circuit device and a bulb base, a flashlight including an assembly, and a method of directly replacing a flashlight bulb.

Owner:LEDDYNAMICS

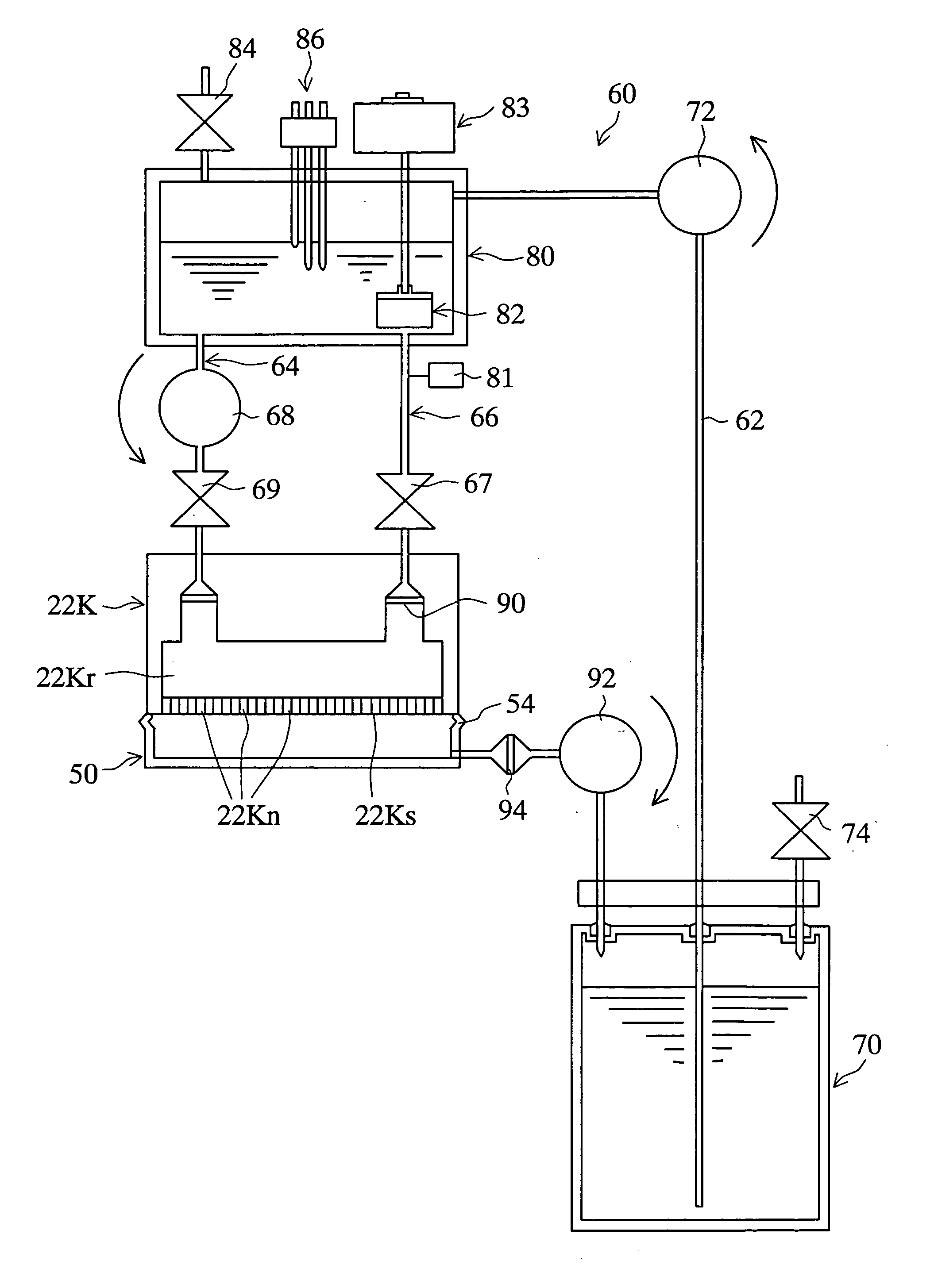

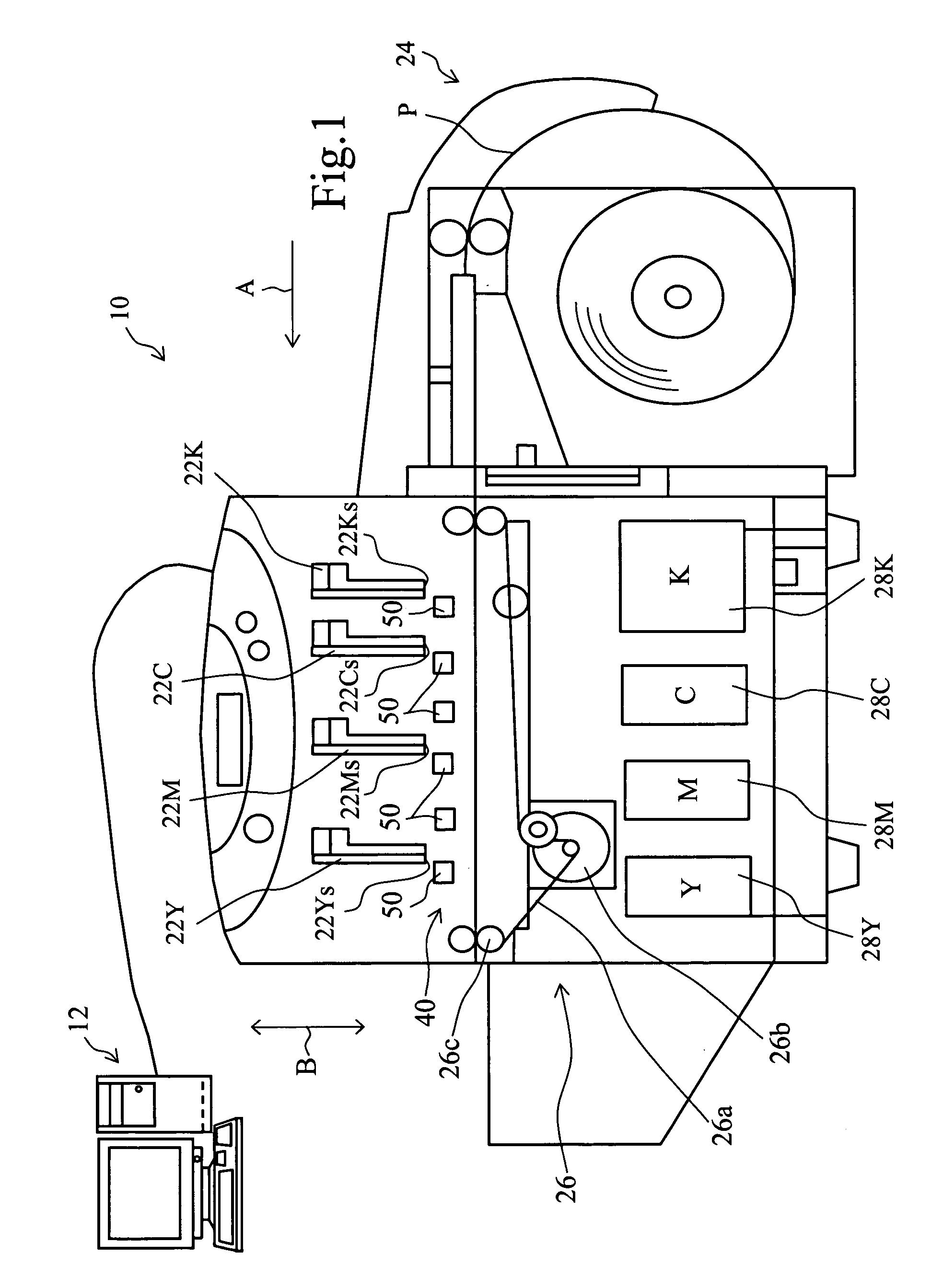

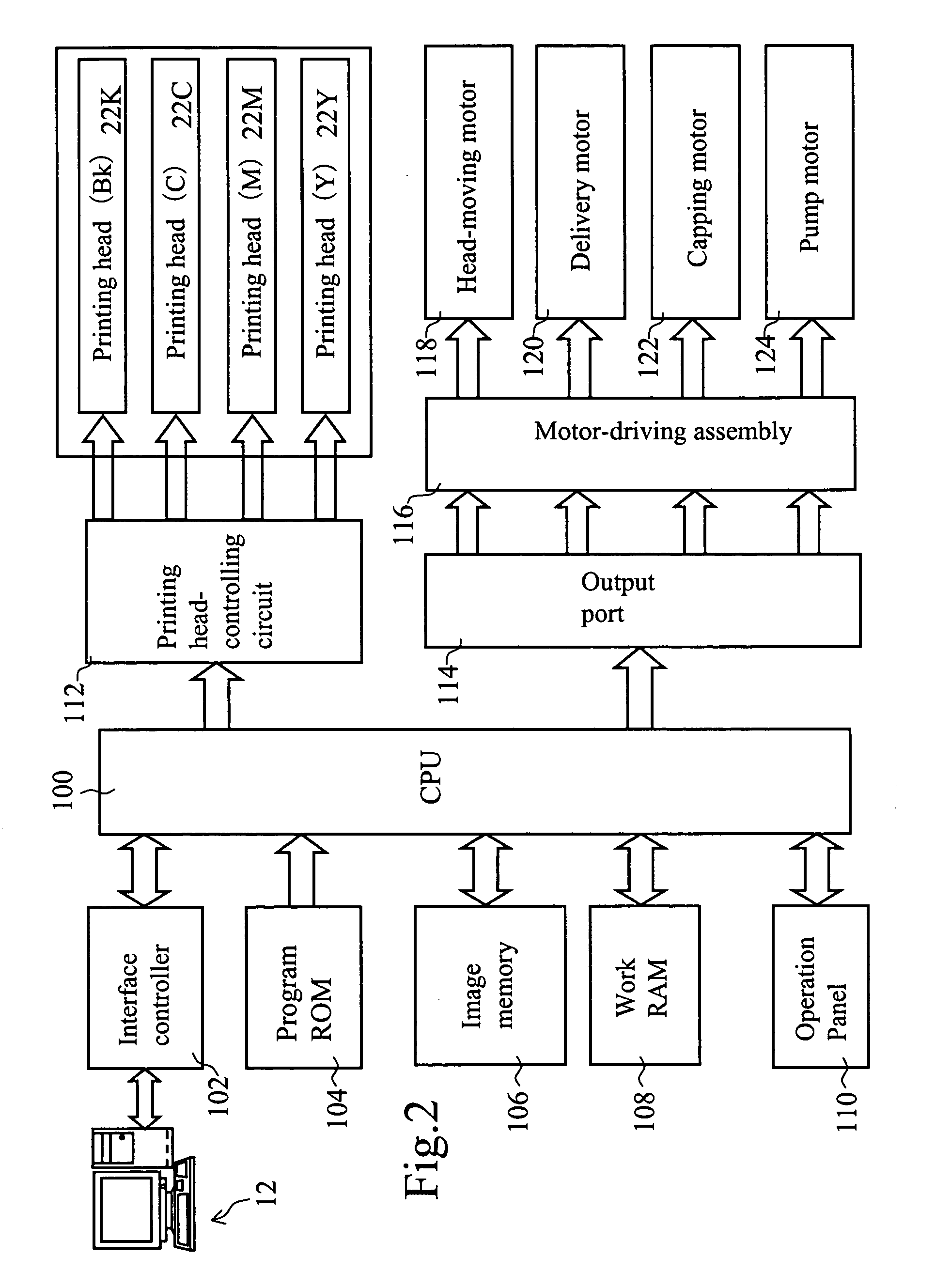

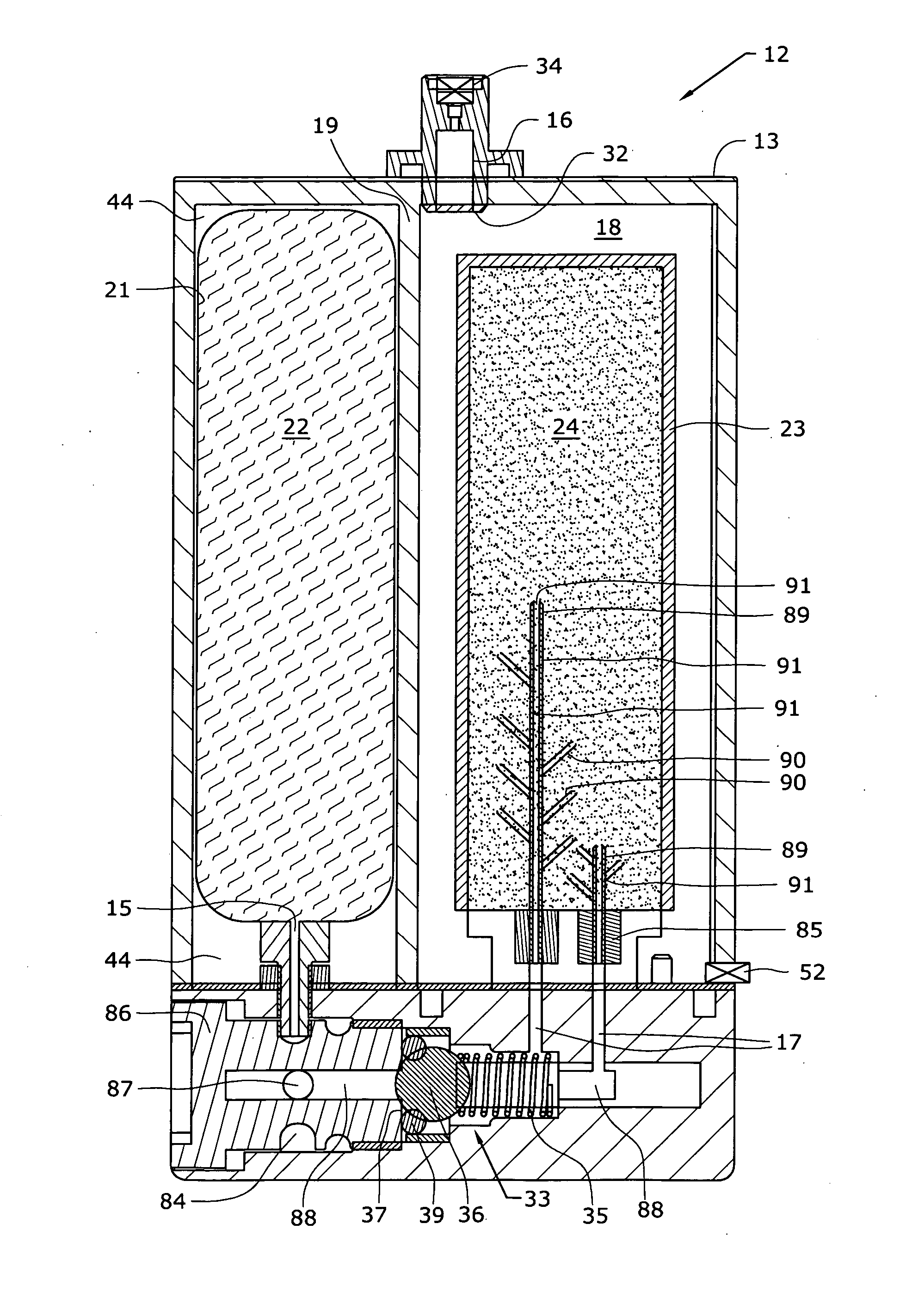

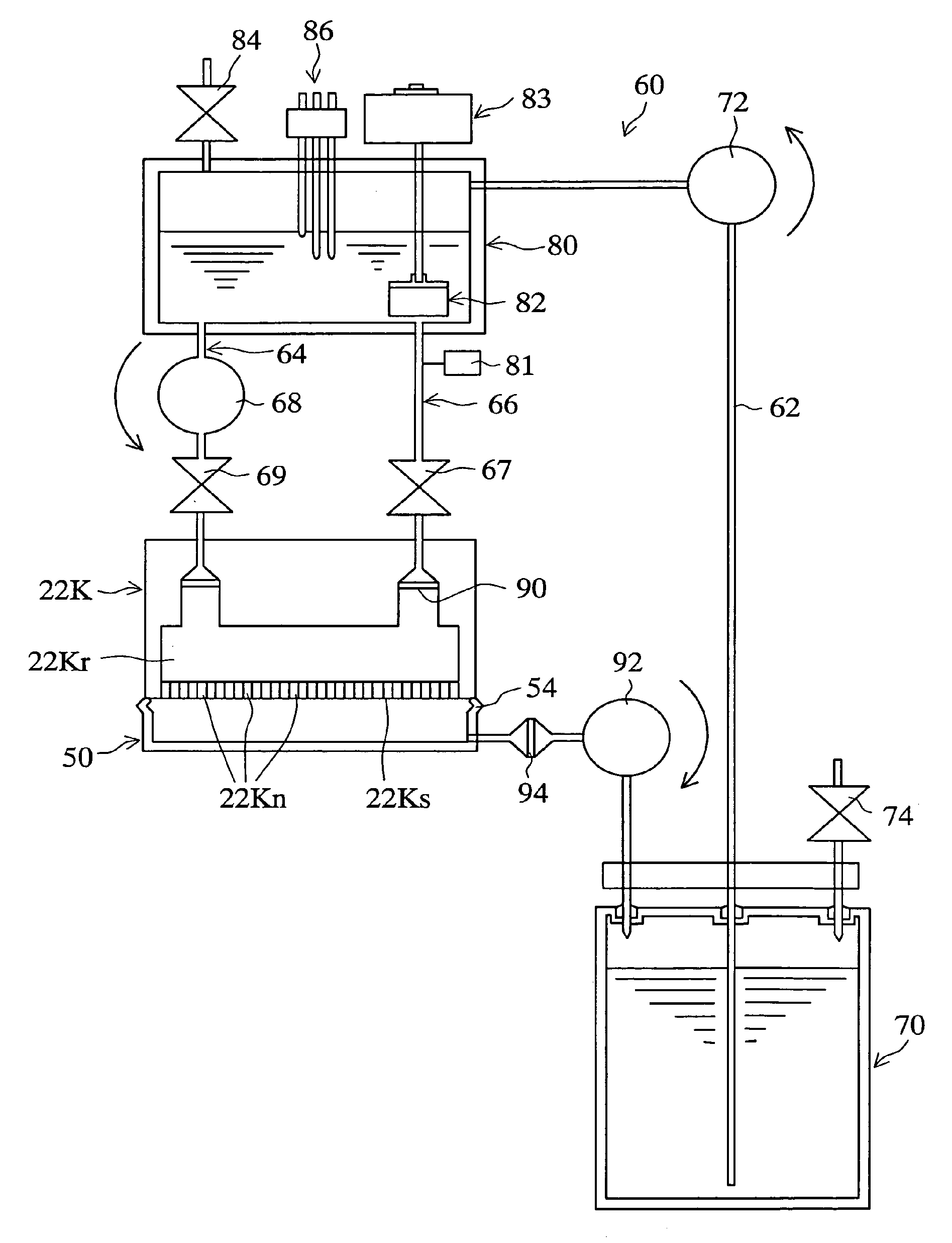

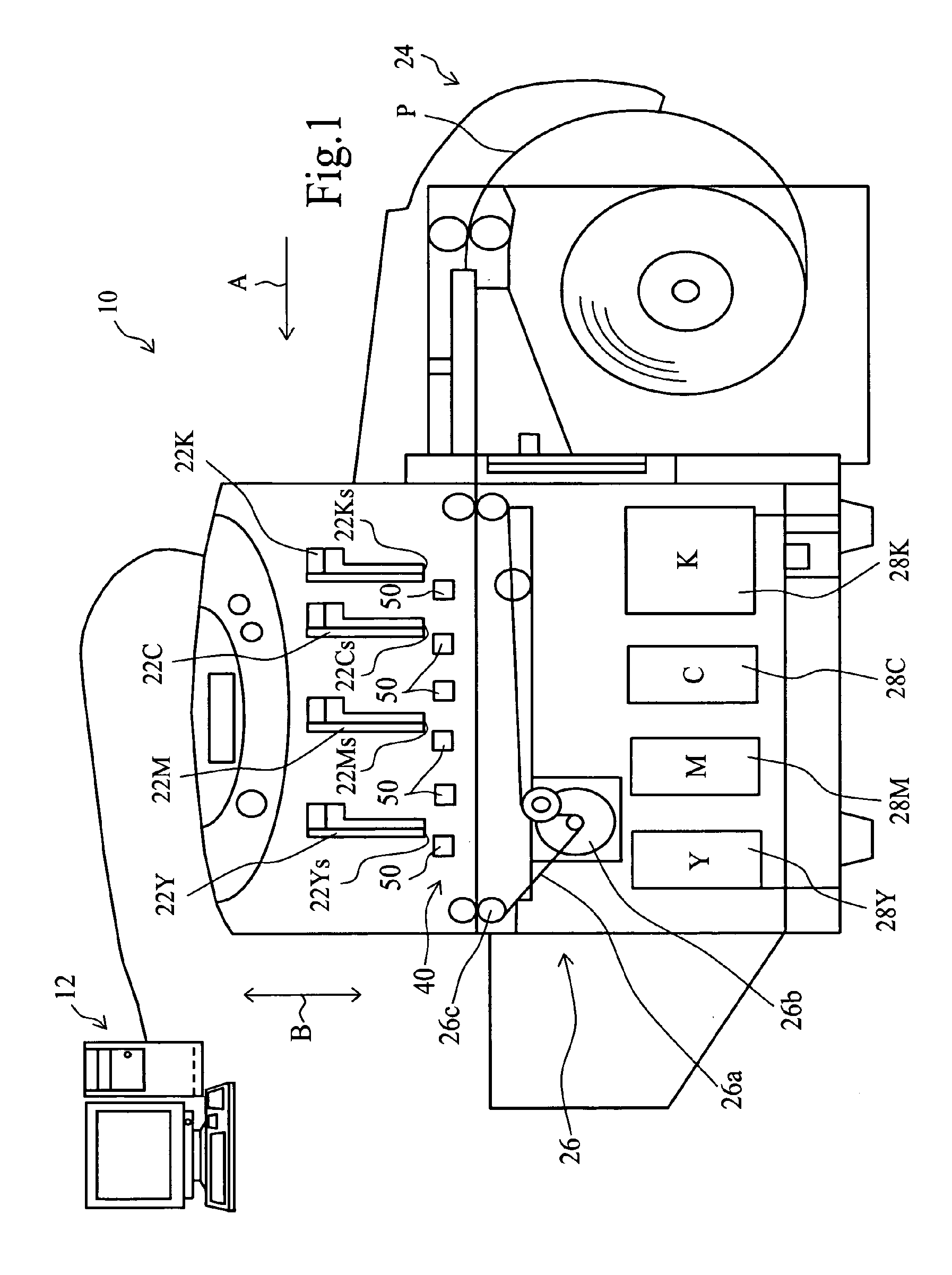

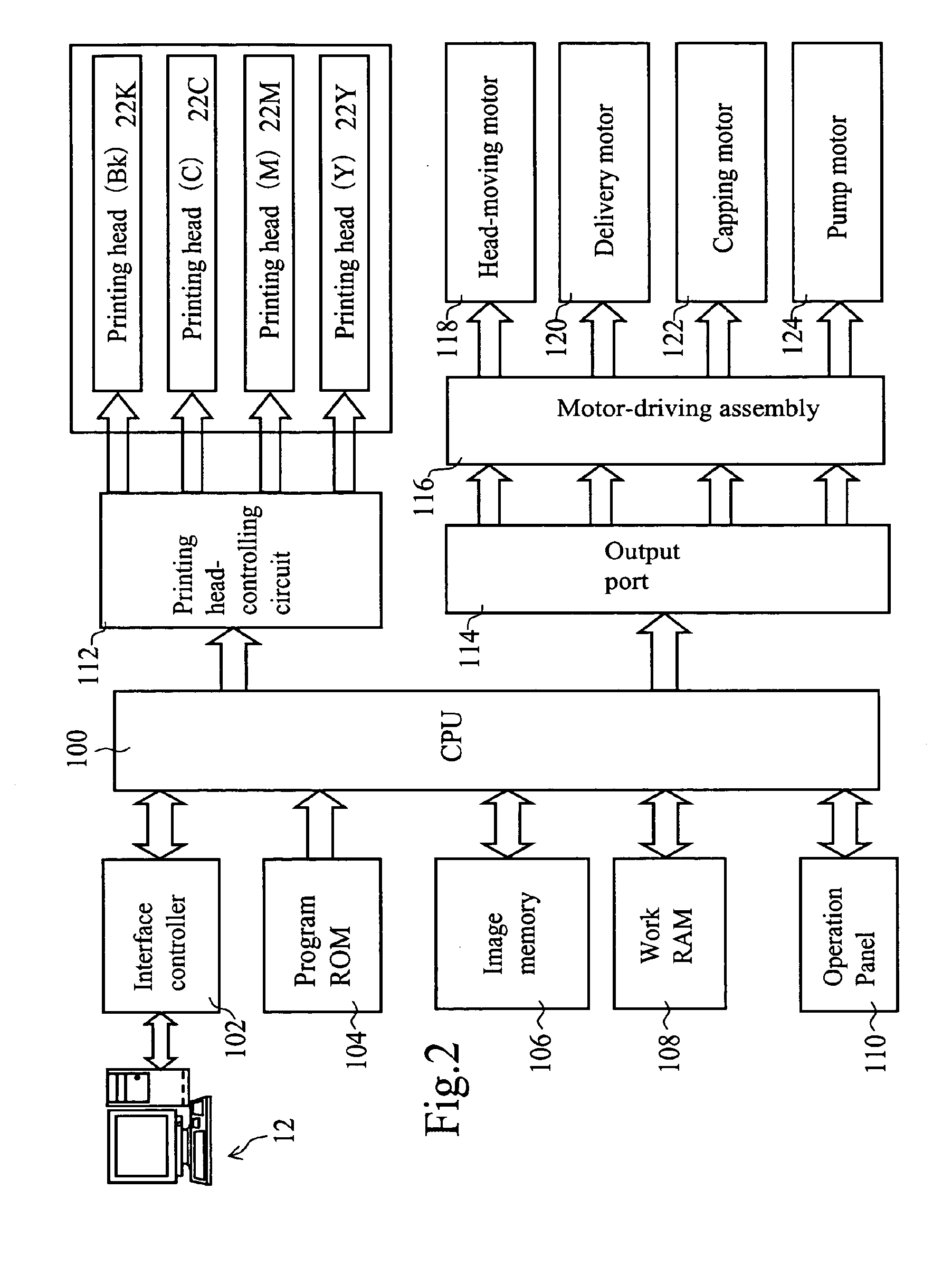

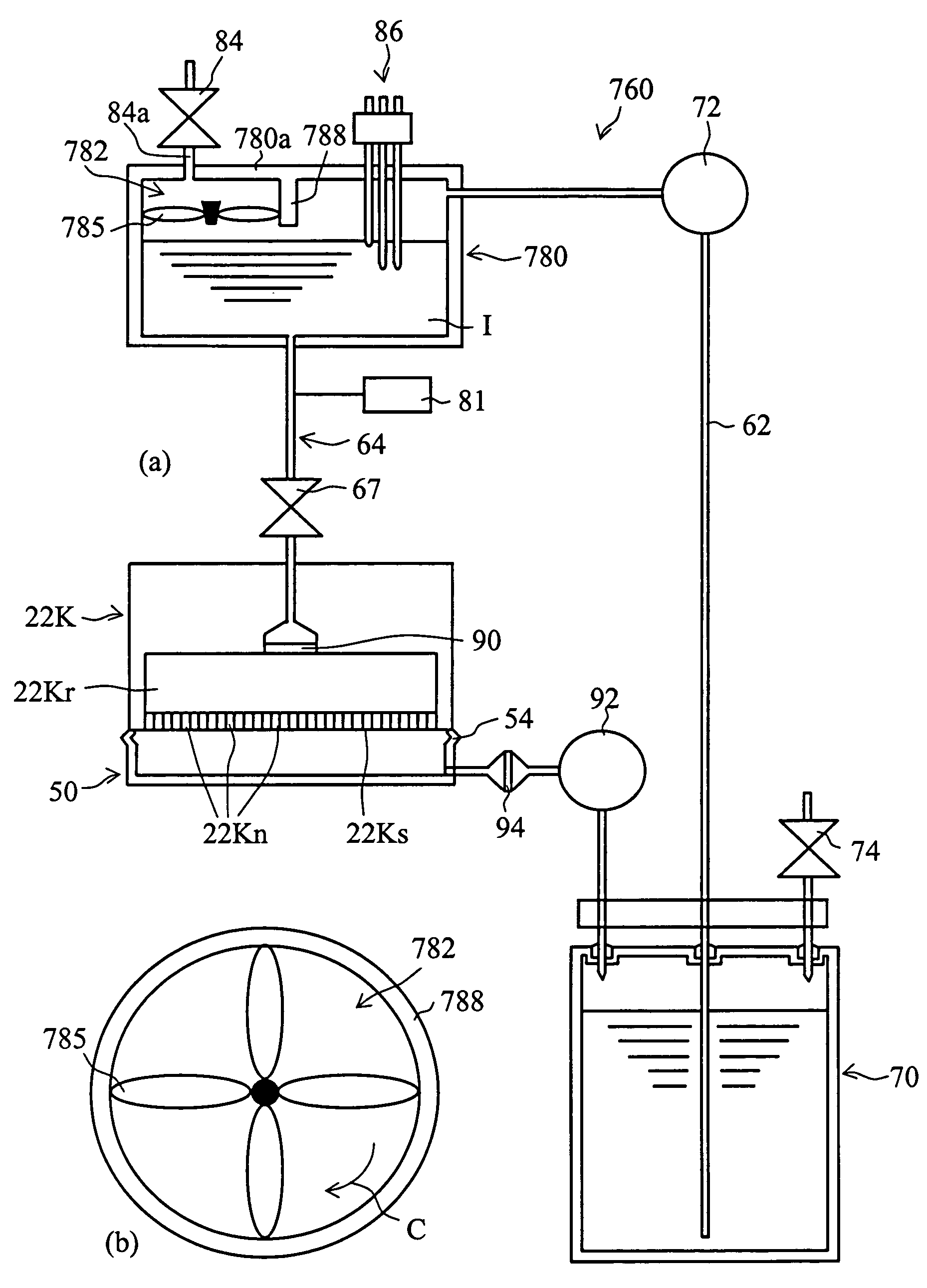

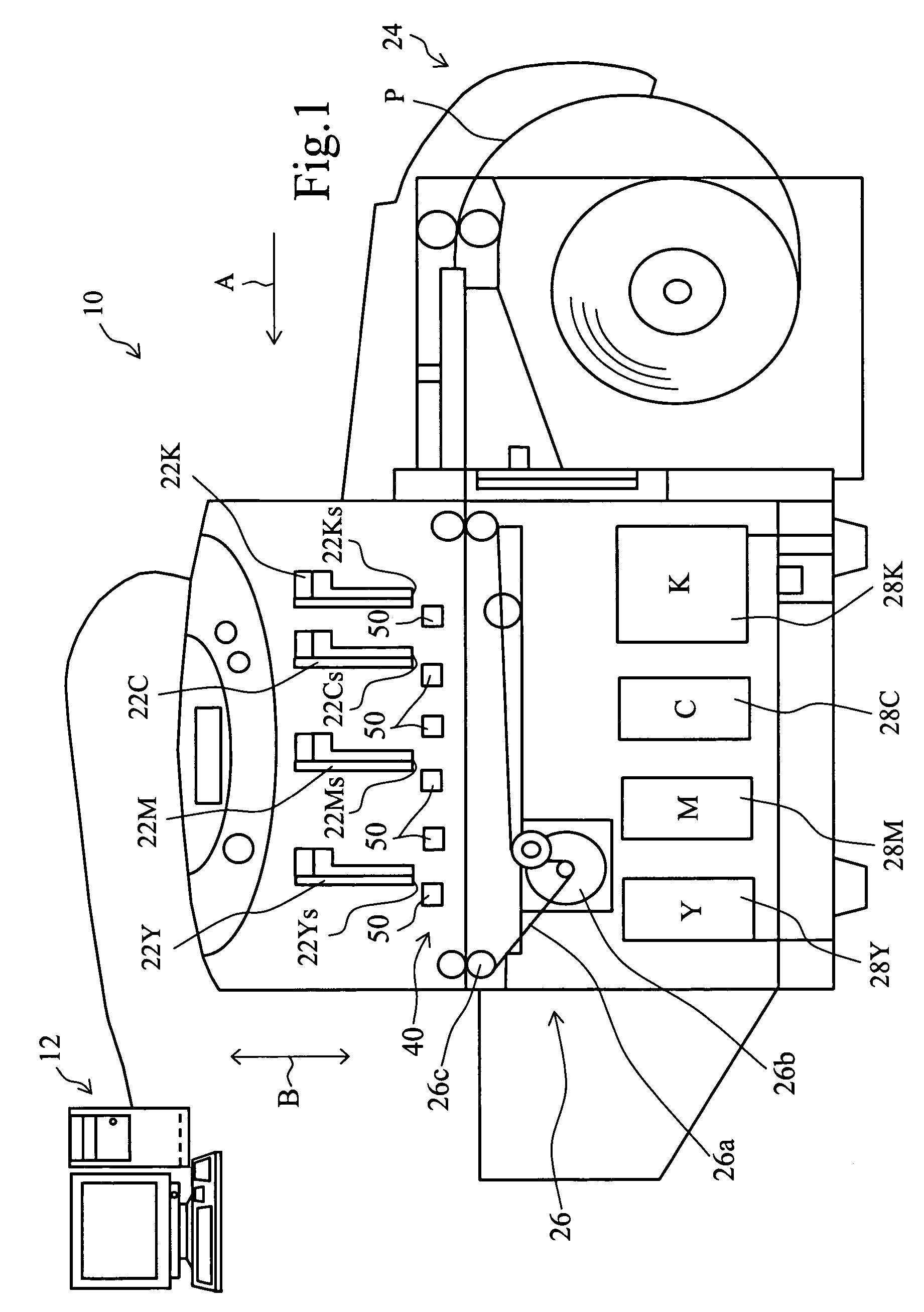

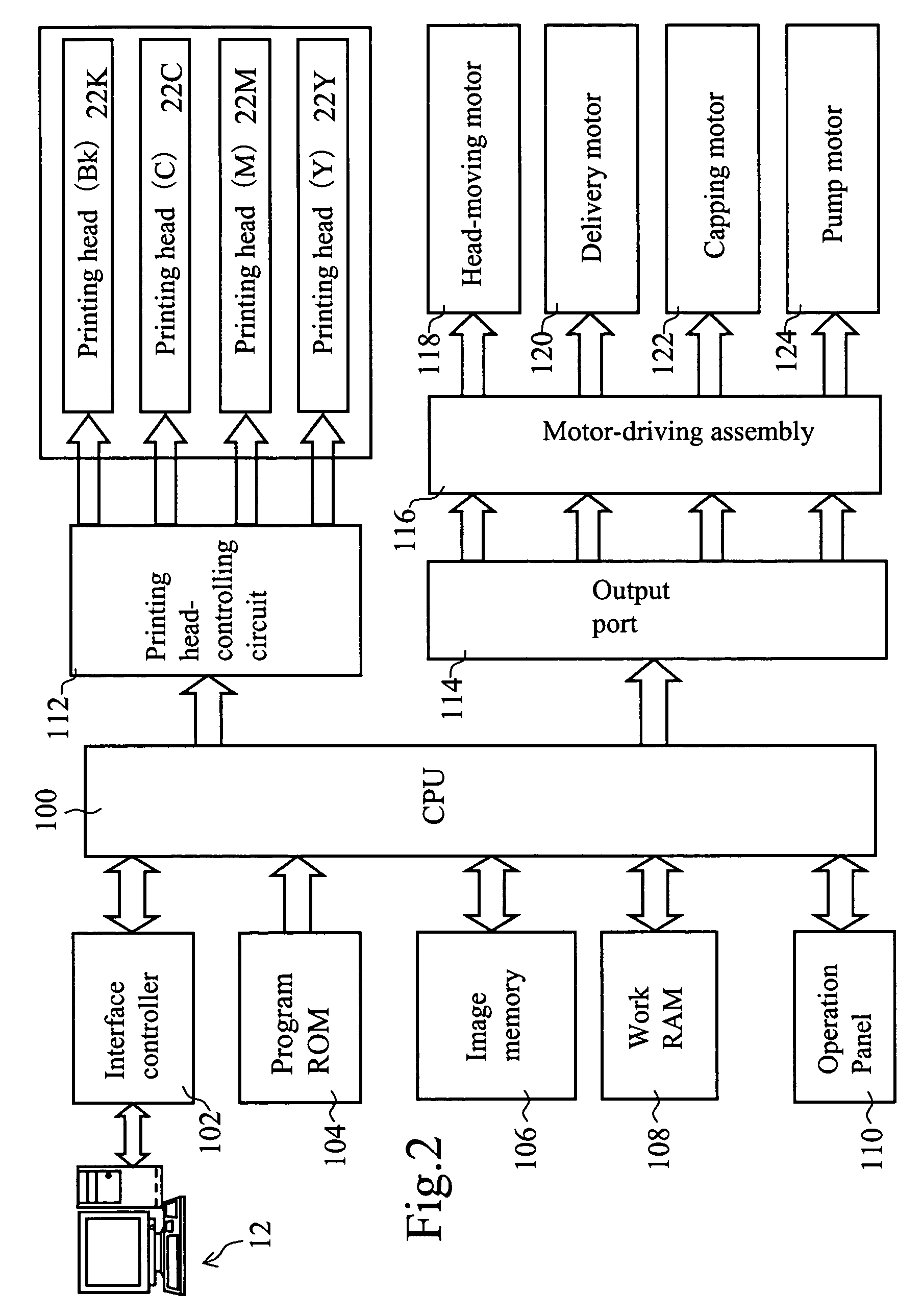

Ink-feeding device and pressure-generating method

InactiveUS20060132554A1Improve recording qualityIncrease freedomPrintingInternal pressureEngineering

An ink-feeding device is provided in which the pressure applied to the ink in the printing head can be adjusted arbitrarily irrespective of the relative positions of the ink container and the printing head. Inside the sub-tank 80, a pressure-adjusting pump 82 is installed for applying a suitable pressure to many nozzles 22Kn of the printing head 22K. This pressure-adjusting pump 82 is placed a little above the bottom face of the sub-tank 80 at a prescribed distance from the bottom face. Thereby the pressure-adjusting pump 82 is immersed in the ink held in the sub-tank 80. A drive unit 83 for driving the pressure-adjusting pump 82 is placed above the sub-tank 80. On the upper wall of the sub-tank 80, an air-vent valve 84 is fixed to bring the inside pressure in the sub-tank 80 to an atmospheric pressure. The inside pressure in the sub-tank 80 is made equal to the atmospheric pressure by opening the air-vent valve 84.

Owner:COPYER

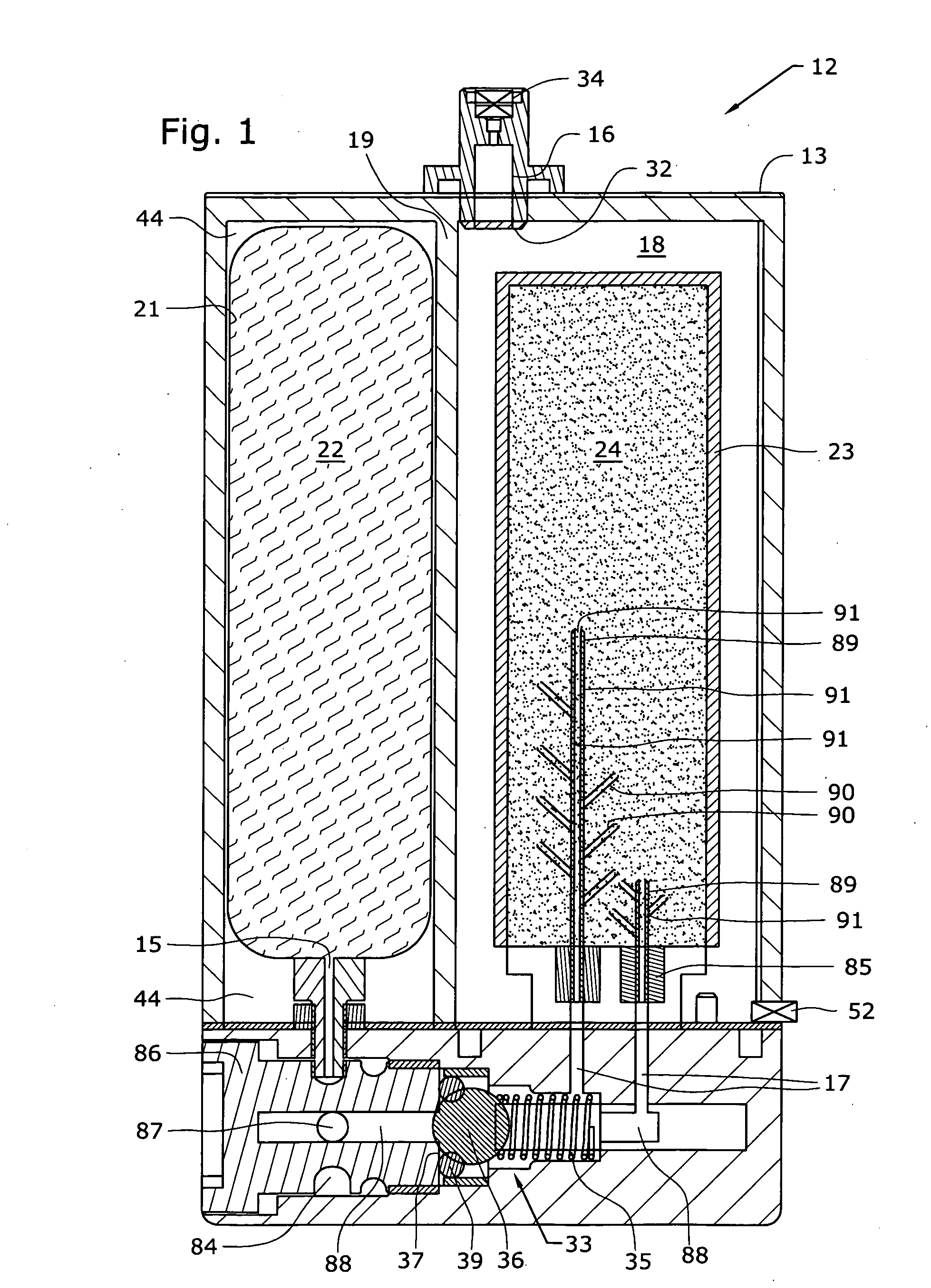

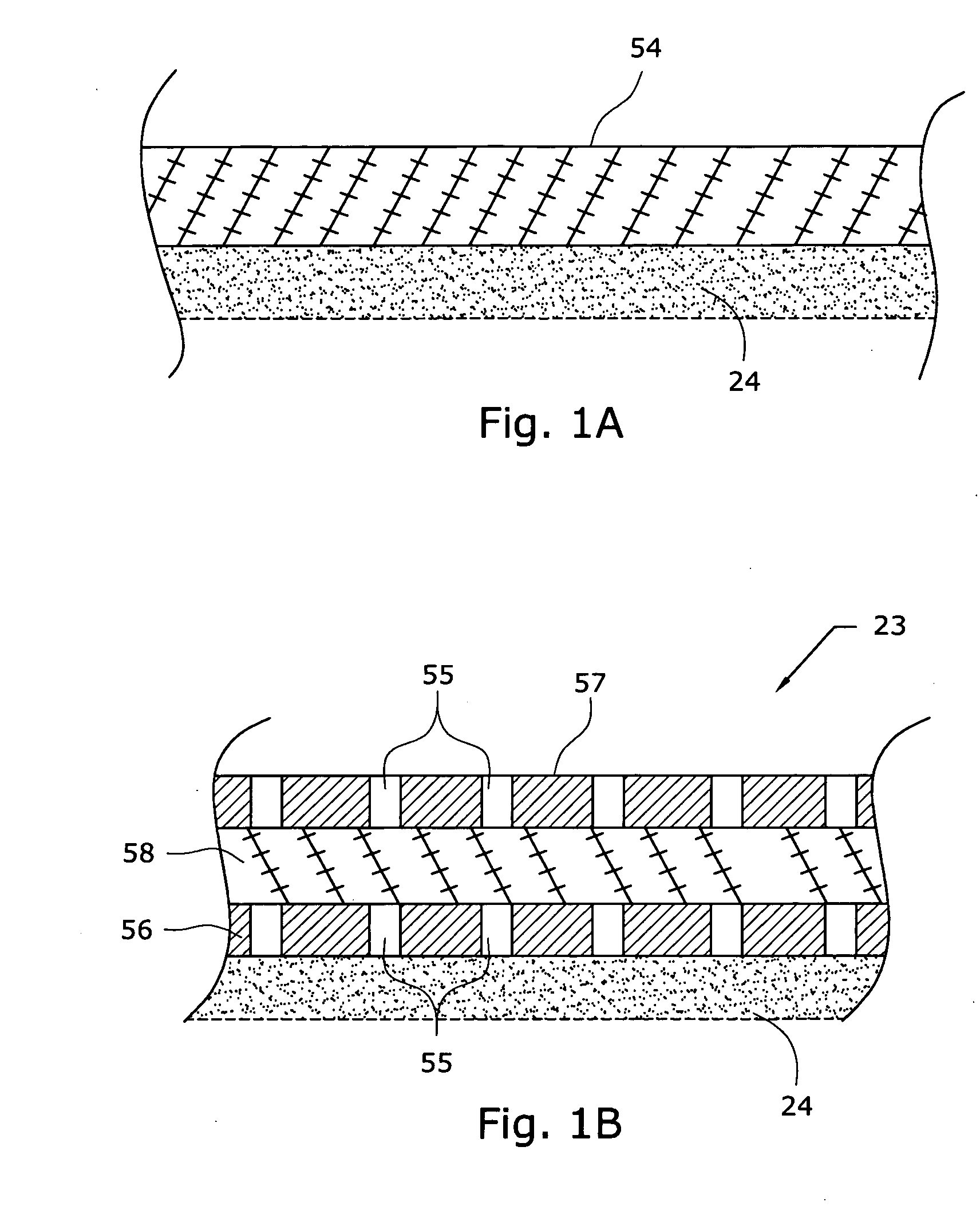

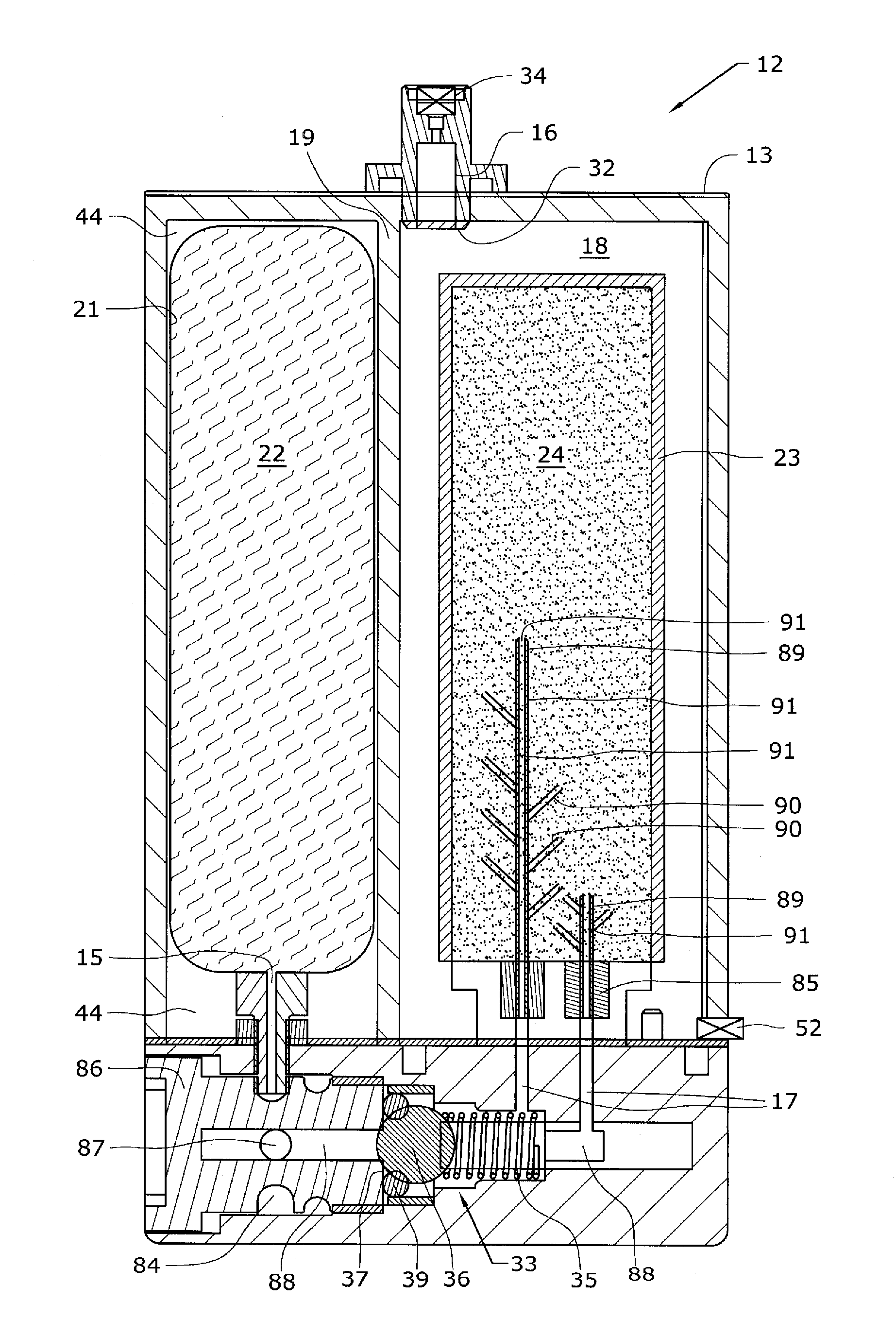

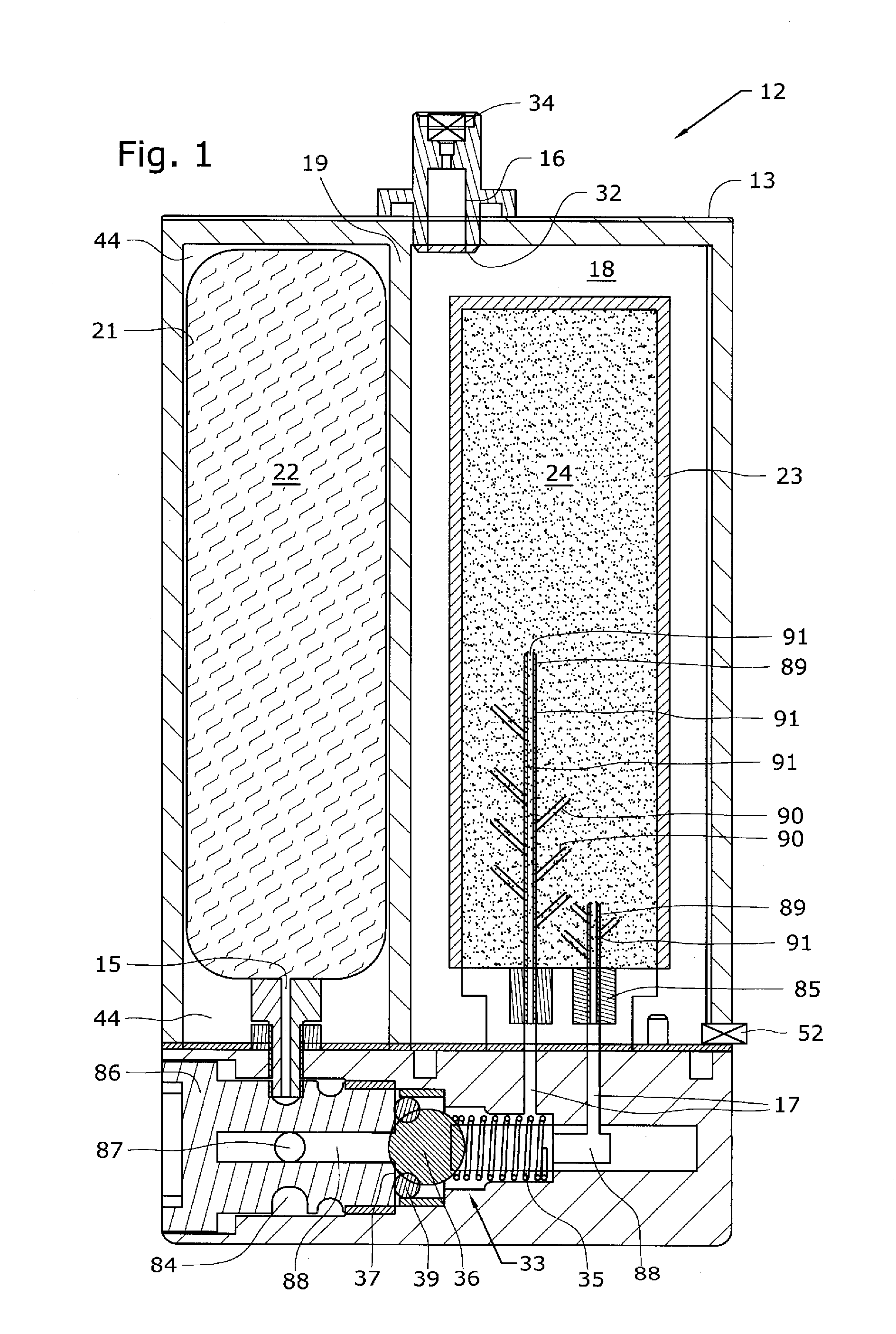

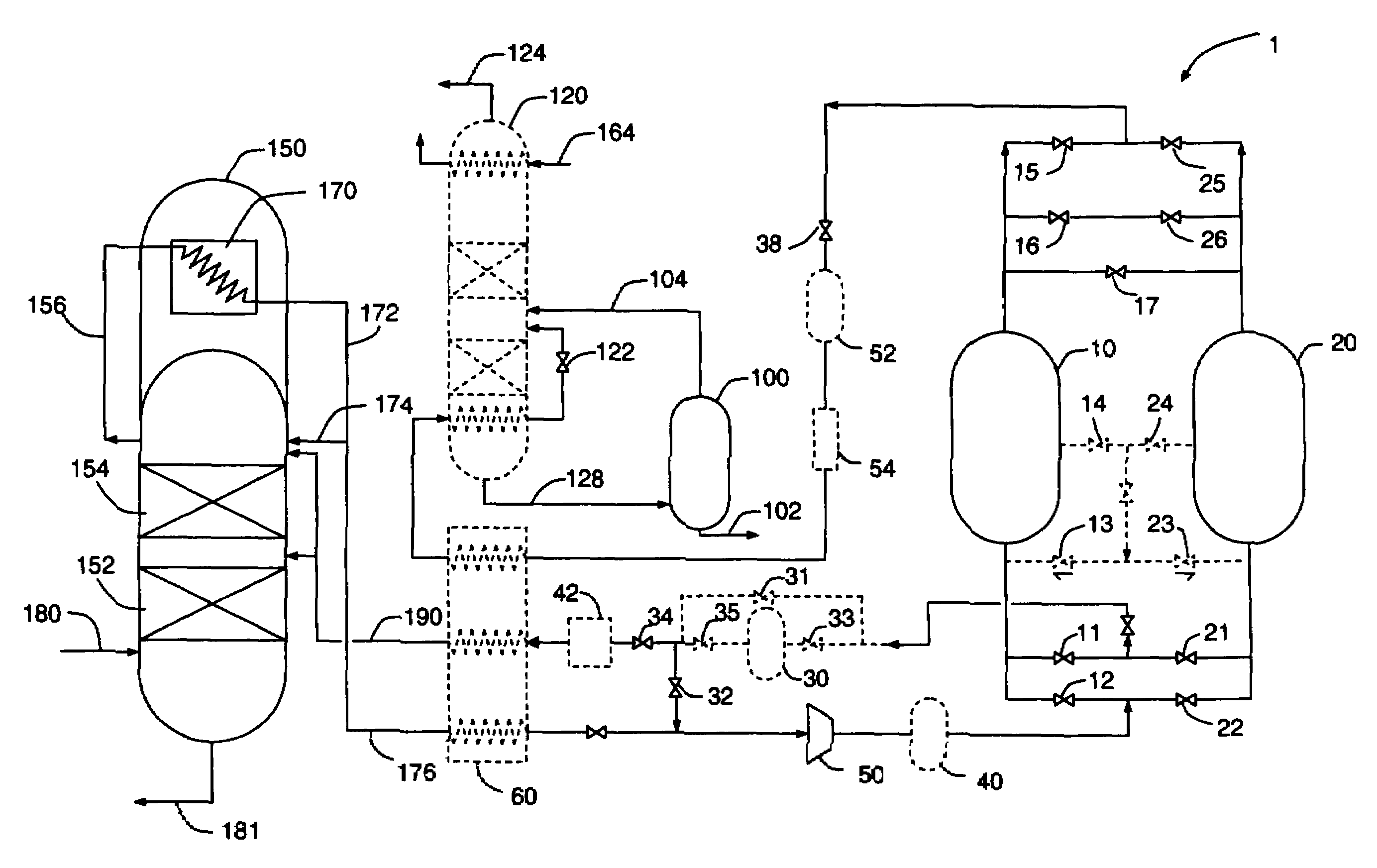

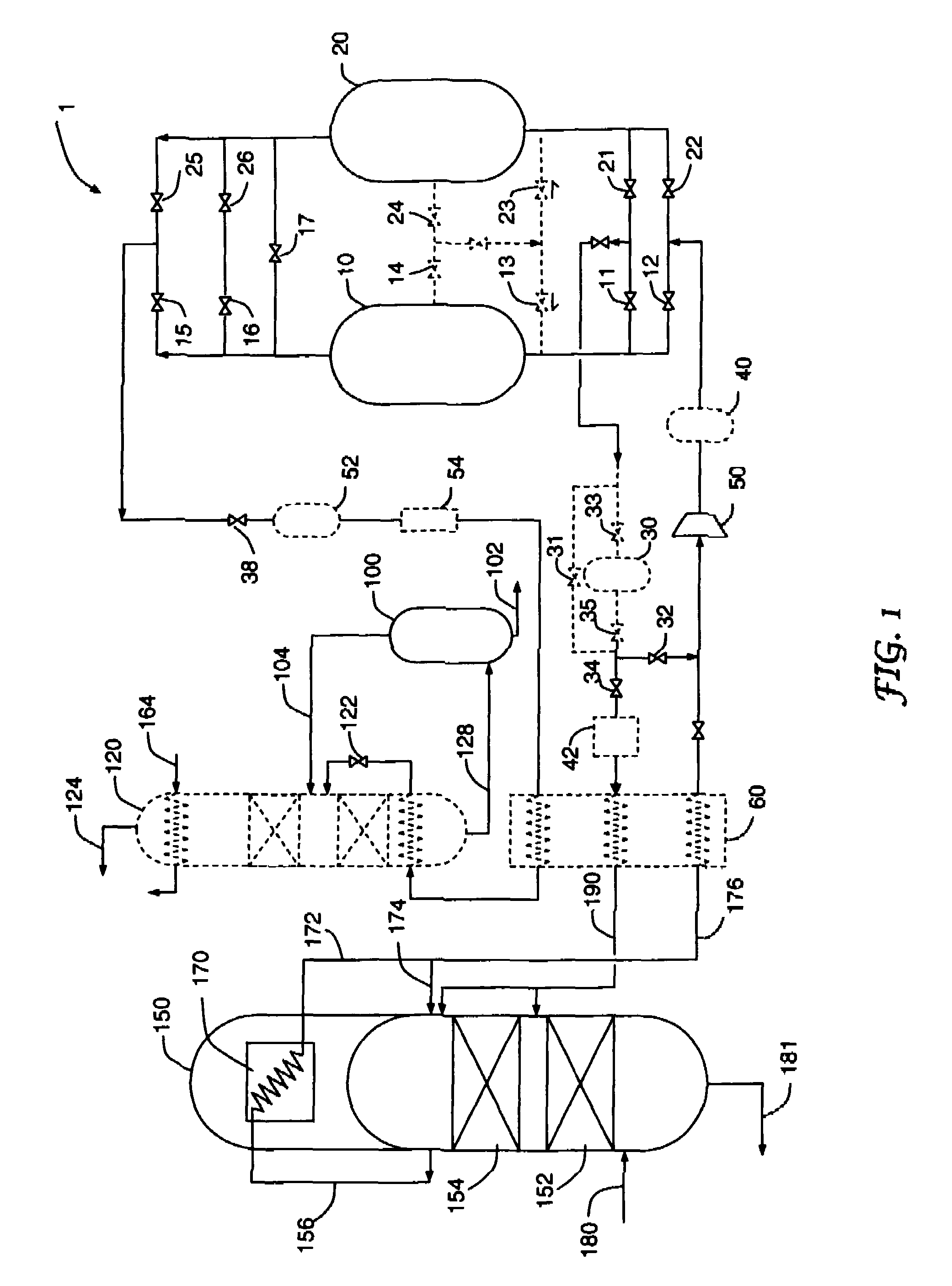

Hydrogen-generating fuel cell cartridges

ActiveUS20060174952A1Minimize fluctuationDiaphragm valvesReactant parameters controlHydrogen pressureNuclear engineering

The present application is directed to a gas-generating apparatus and various pressure regulators or pressure-regulating valves. Hydrogen is generated within the gas-generating apparatus and is transported to a fuel cell. The transportation of a first fuel component to a second fuel component to generate of hydrogen occurs automatically depending on the pressure of a reaction chamber within the gas-generating apparatus. The pressure regulators and flow orifices are provided to regulate the hydrogen pressure and to minimize the fluctuation in pressure of the hydrogen received by the fuel cell. Connecting valves to connect the gas-generating apparatus to the fuel cell are also provided.

Owner:INTELLIGENT ENERGY LTD

Hydrogen-Generating Fuel Cell Cartridges

ActiveUS20080233462A1Minimize fluctuationDiaphragm valvesOperating means/releasing devices for valvesFuel cellsNuclear engineering

Owner:INTELLIGENT ENERGY LTD

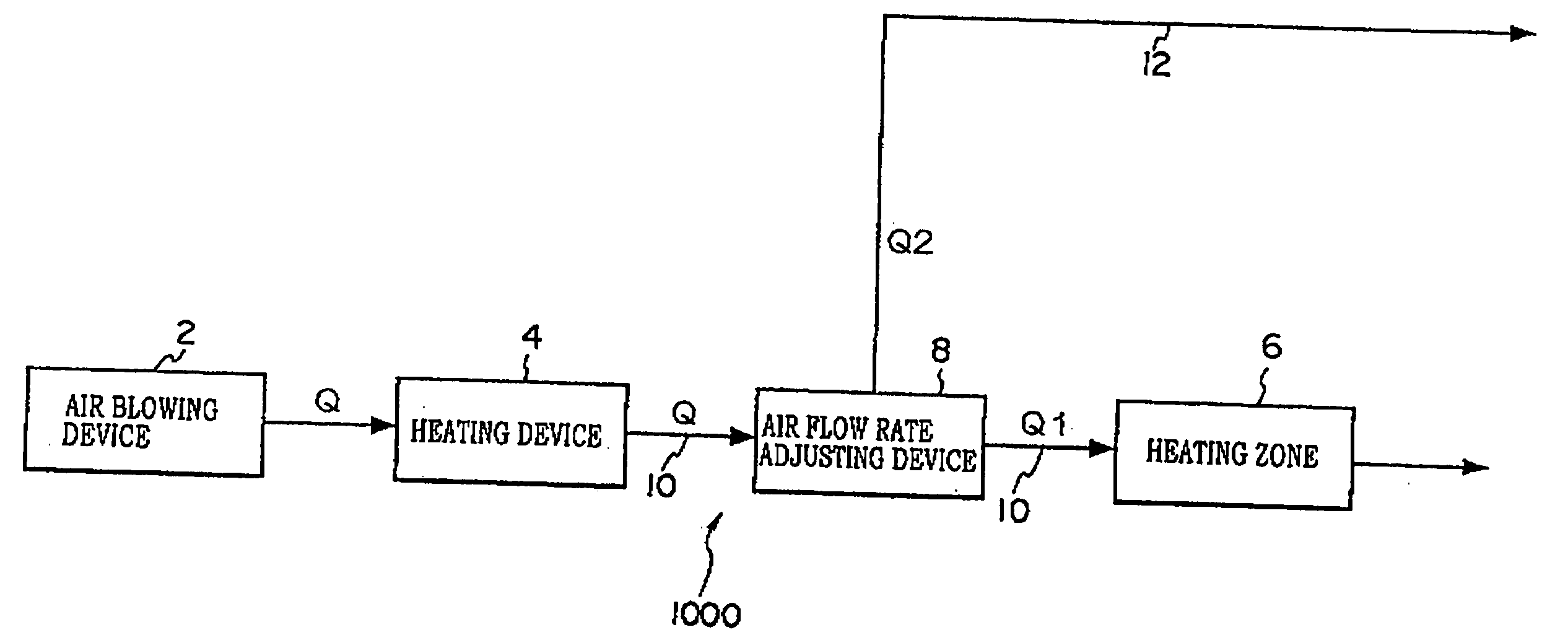

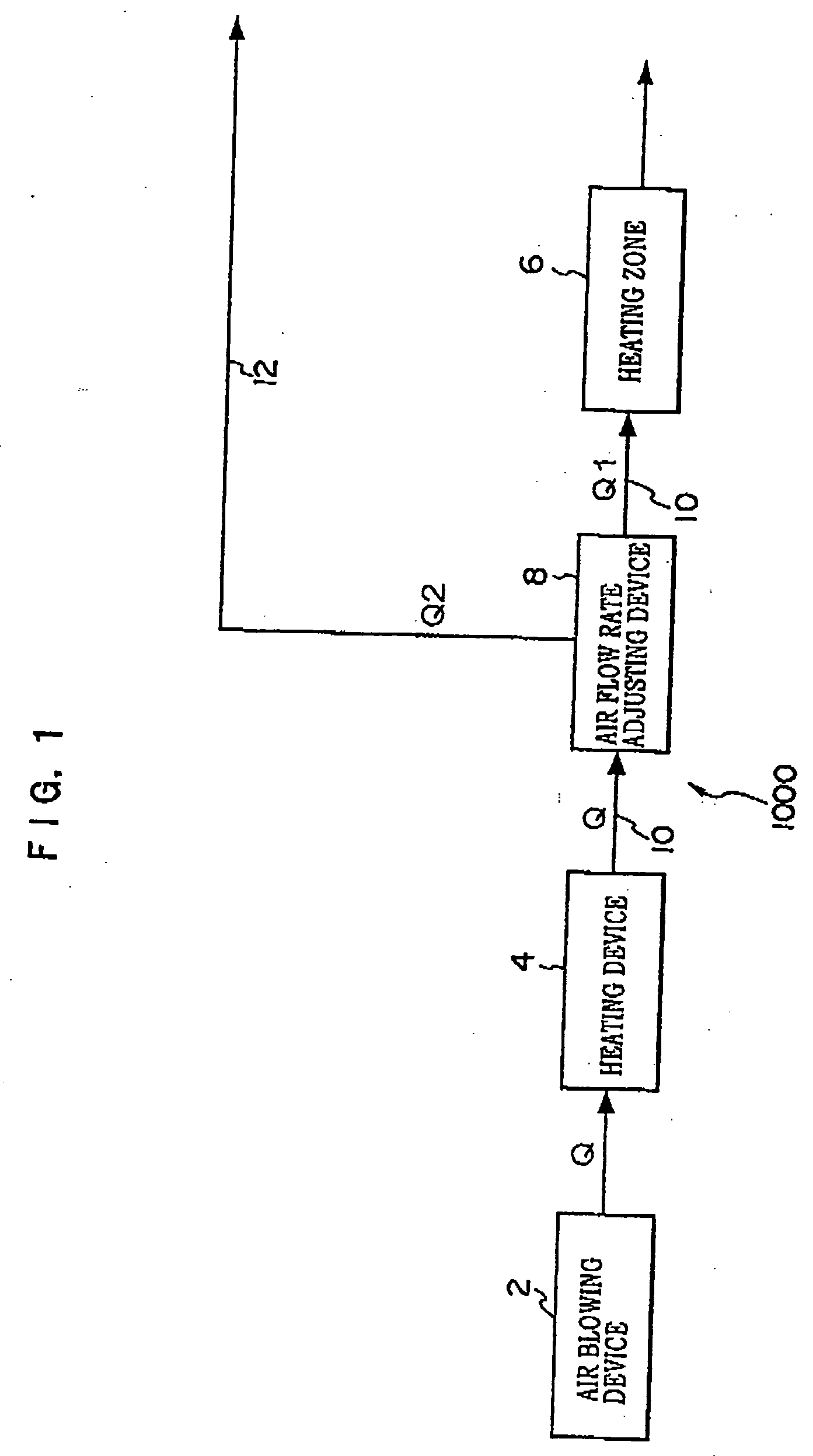

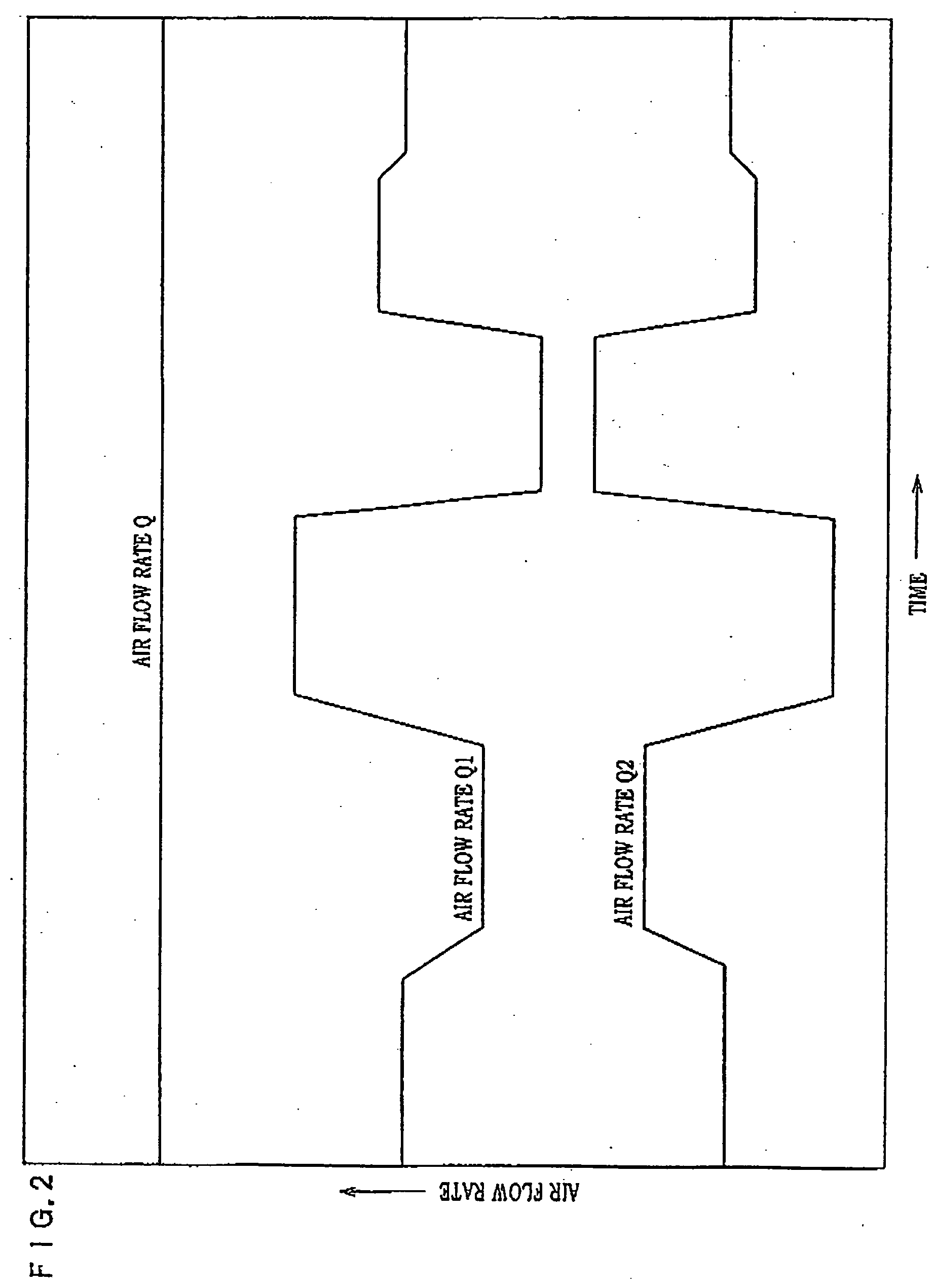

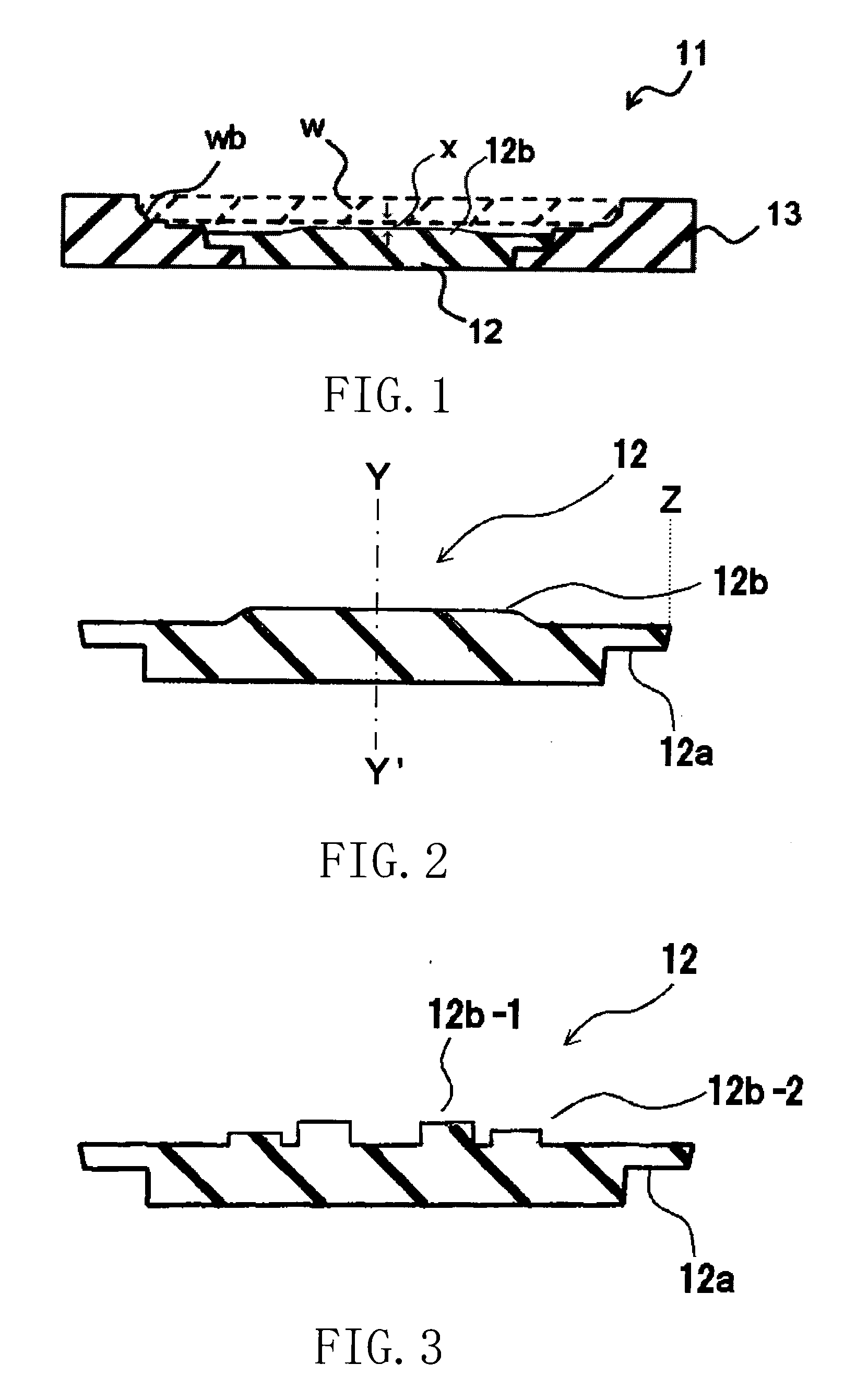

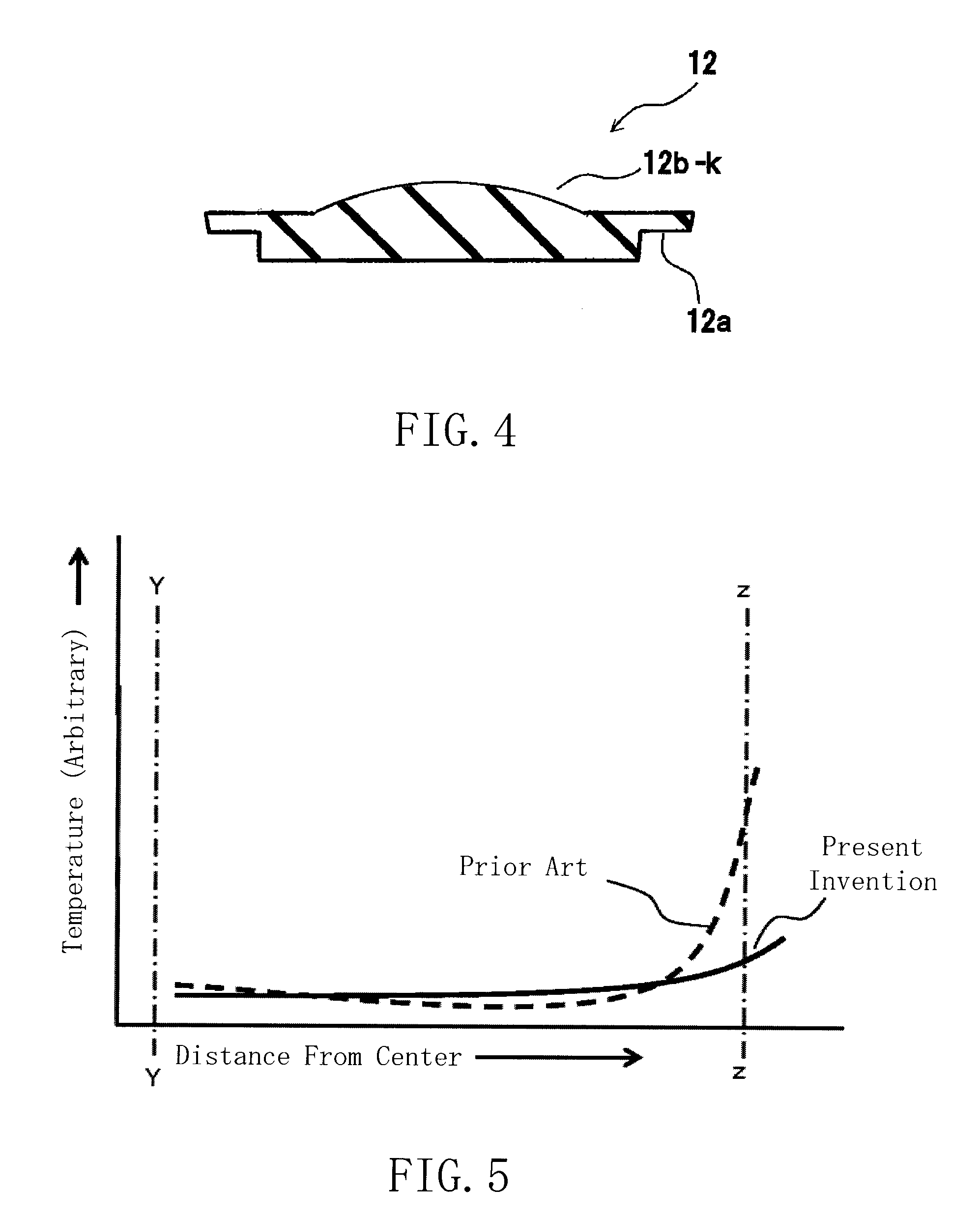

Heating method for a band-shaped body and heating apparatus for a band-shaped body

InactiveUS20050121436A1Minimize fluctuationMaterial minimizationDrying solid materials with heatPhotomechanical apparatusBand shapeElectrical and Electronics engineering

Owner:FUJIFILM HLDG CORP +1

Combined cryogenic distillation and PSA for argon production

ActiveUS7501009B2Improvements in the refining of crude argonSpeed up the processSolidificationLiquefactionParticulatesFiltration

A method and apparatus for producing high purity argon by combined cryogenic distillation and adsorption technologies is disclosed. Crude argon from a distillation column or a so-called argon column is passed to a system of adsorption vessels for further purification. Depressurization gas from adsorption is introduced back, in a controlled manner, to the distillation column and / or a compressor or other means for increasing pressure. Particulate filtration and getter purification may optionally be used.

Owner:AIR PROD & CHEM INC

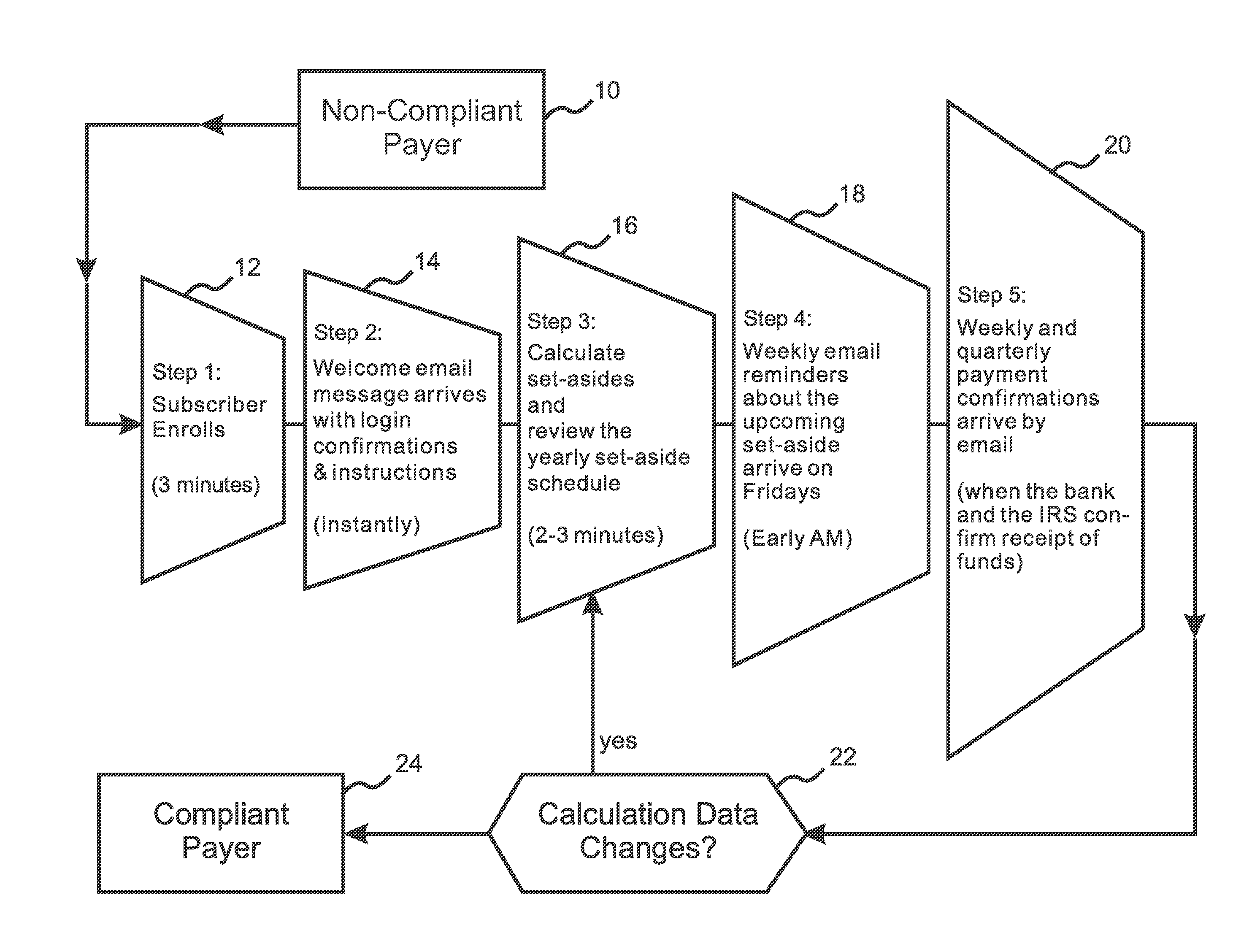

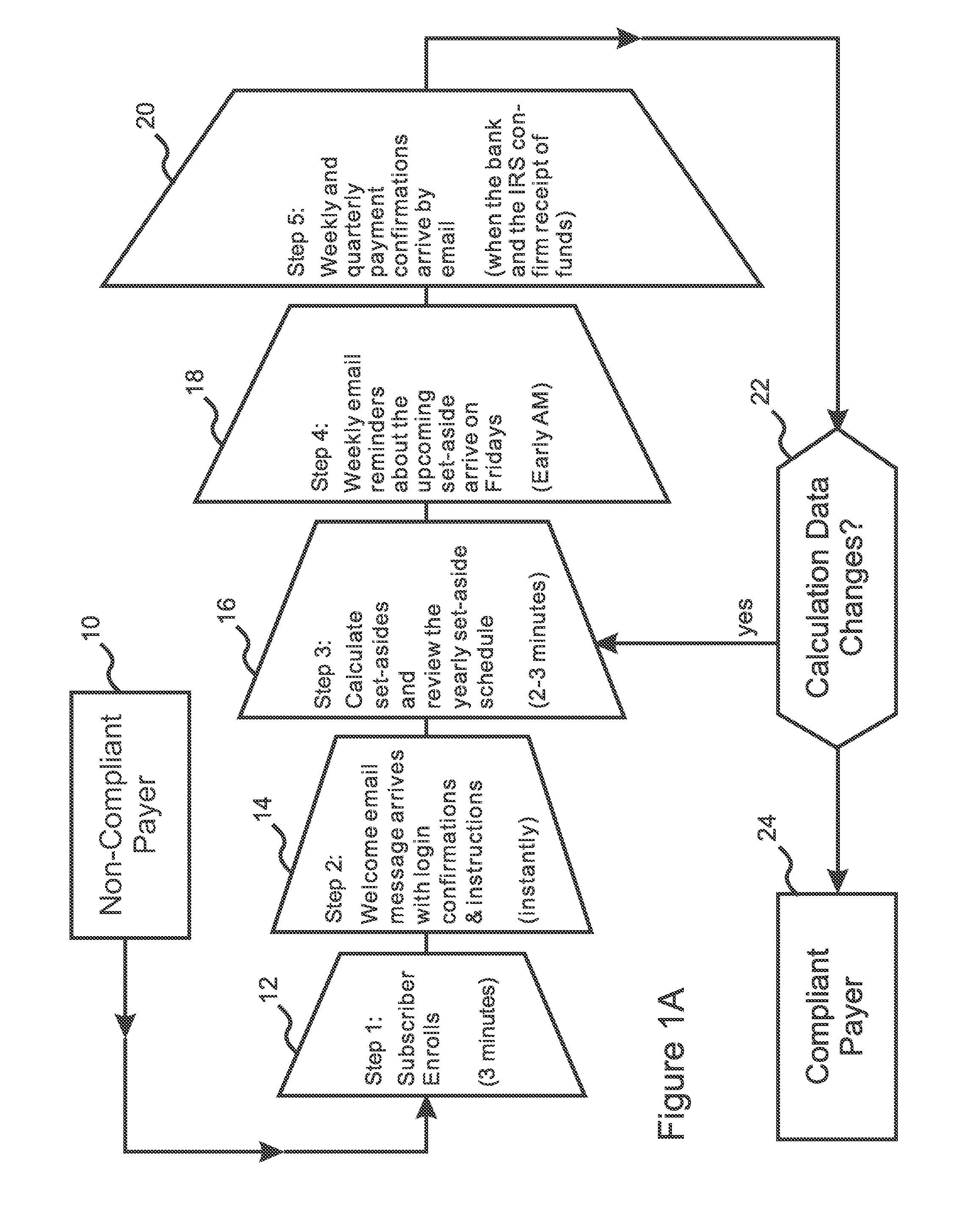

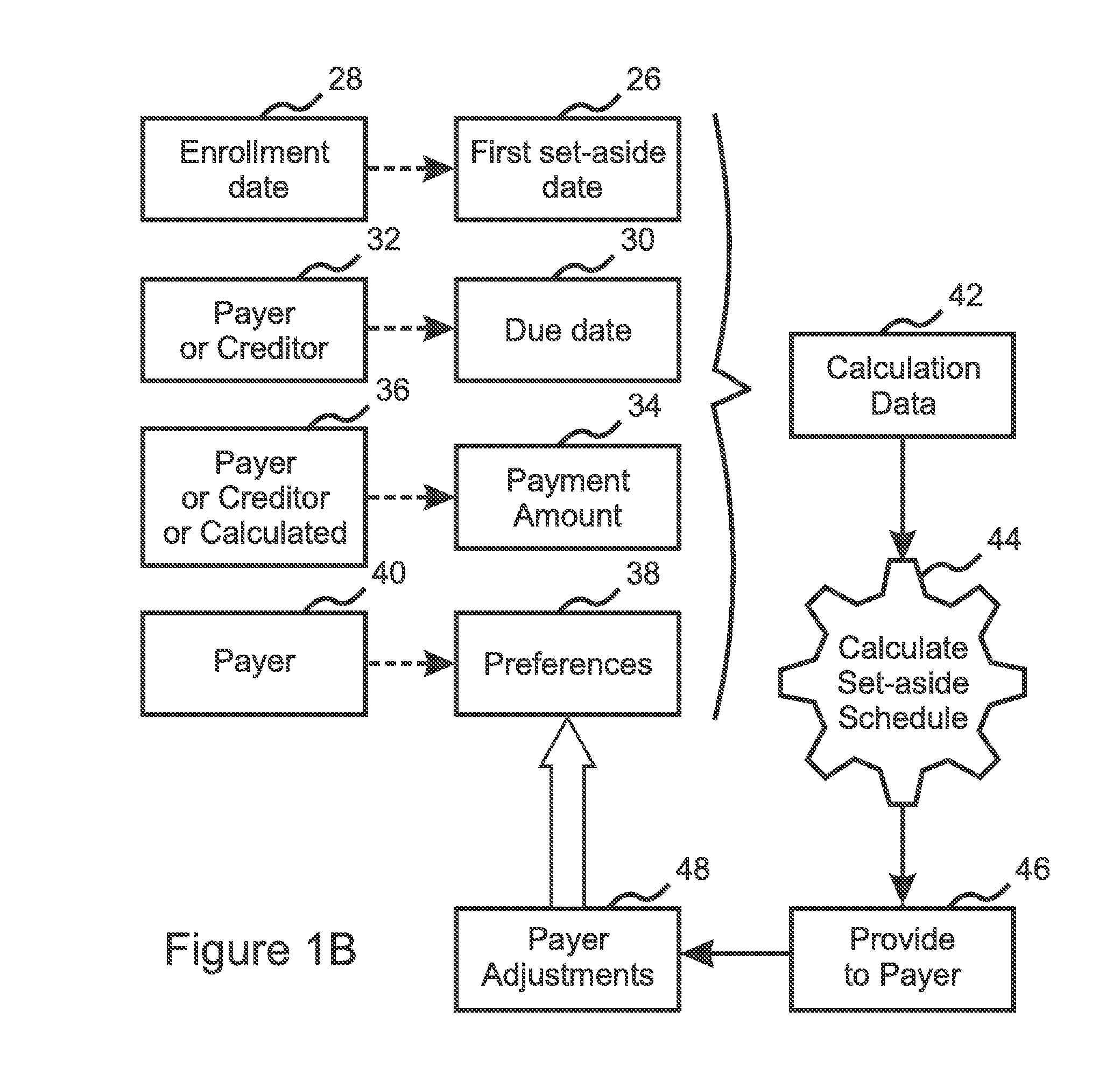

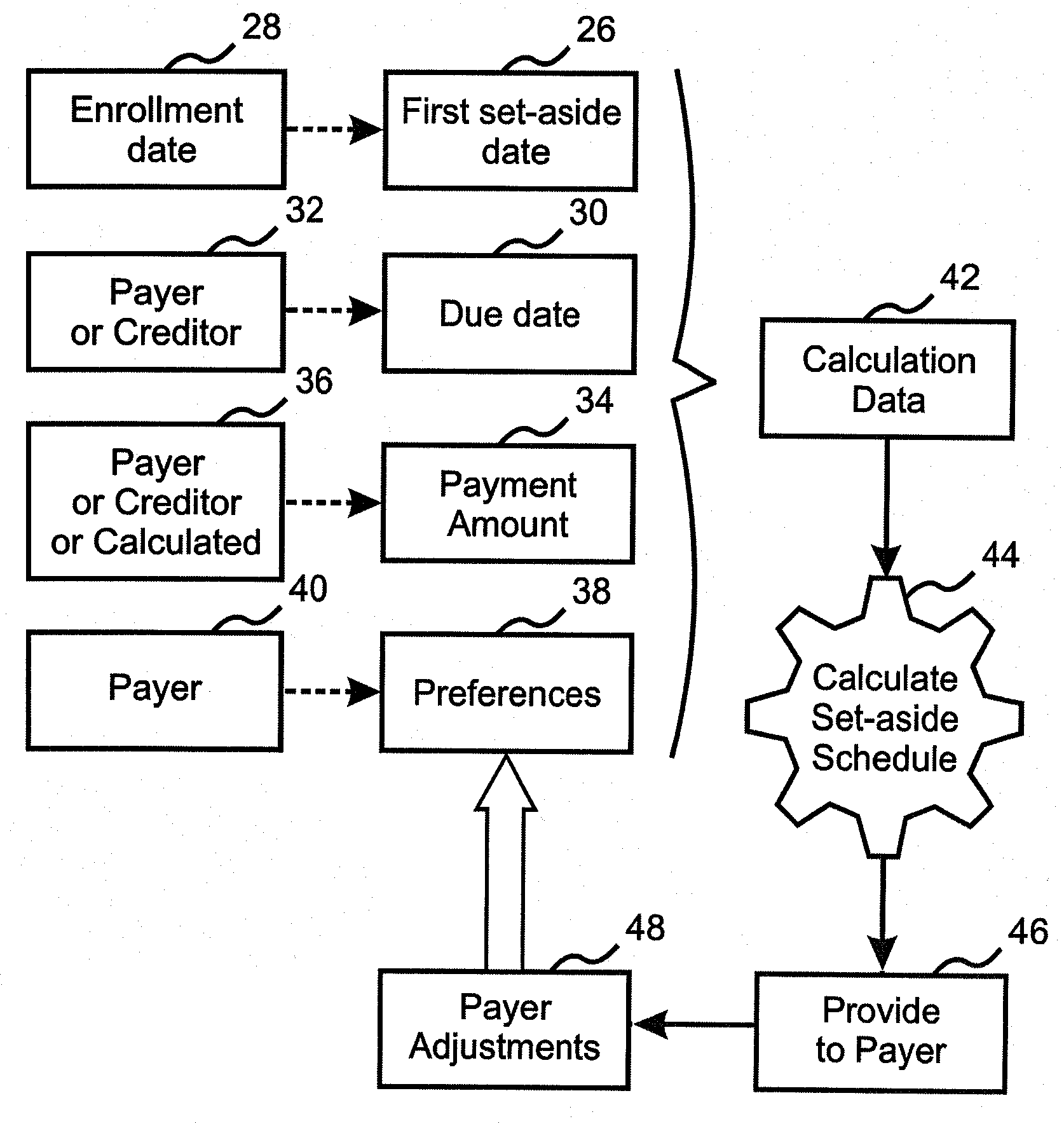

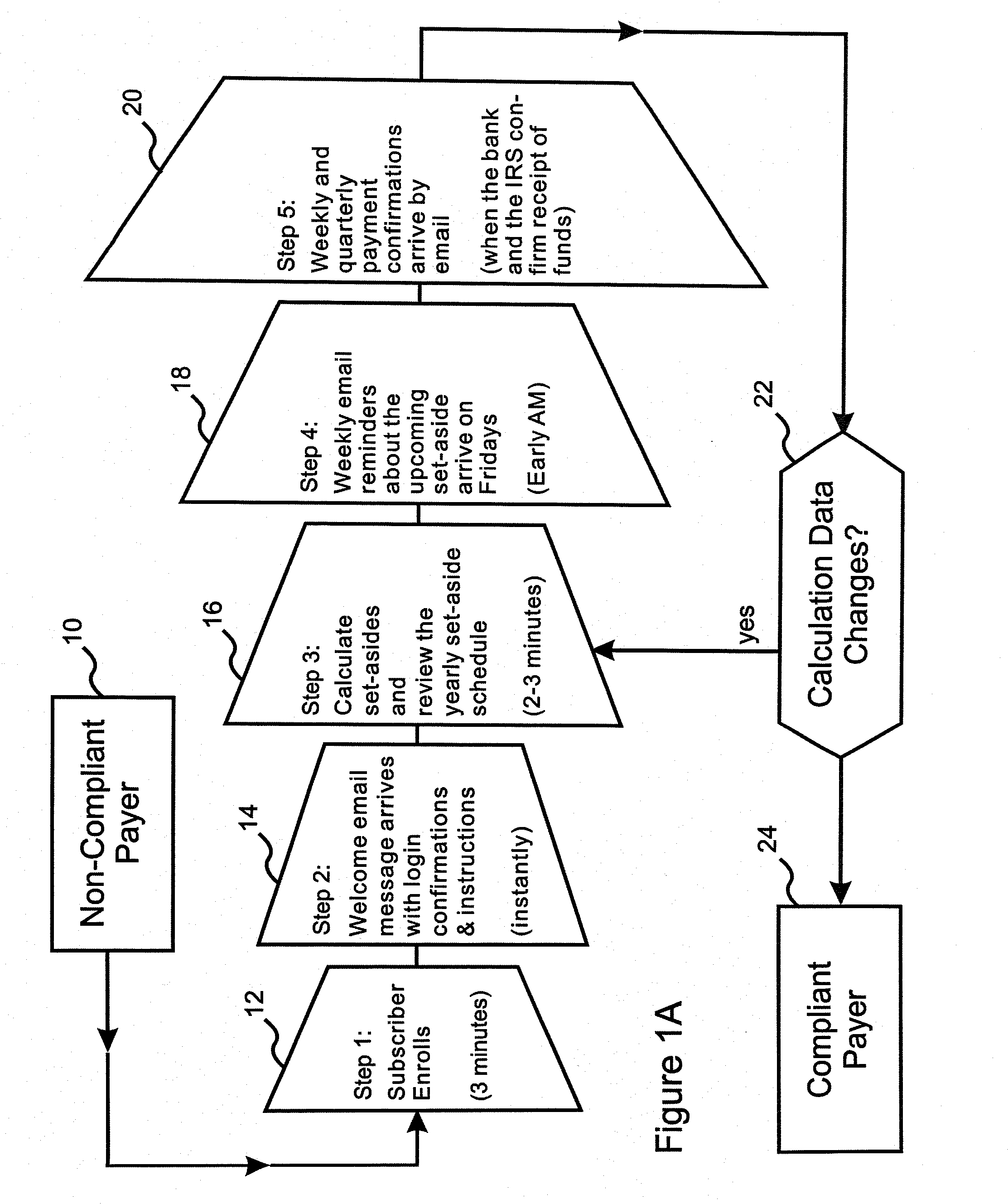

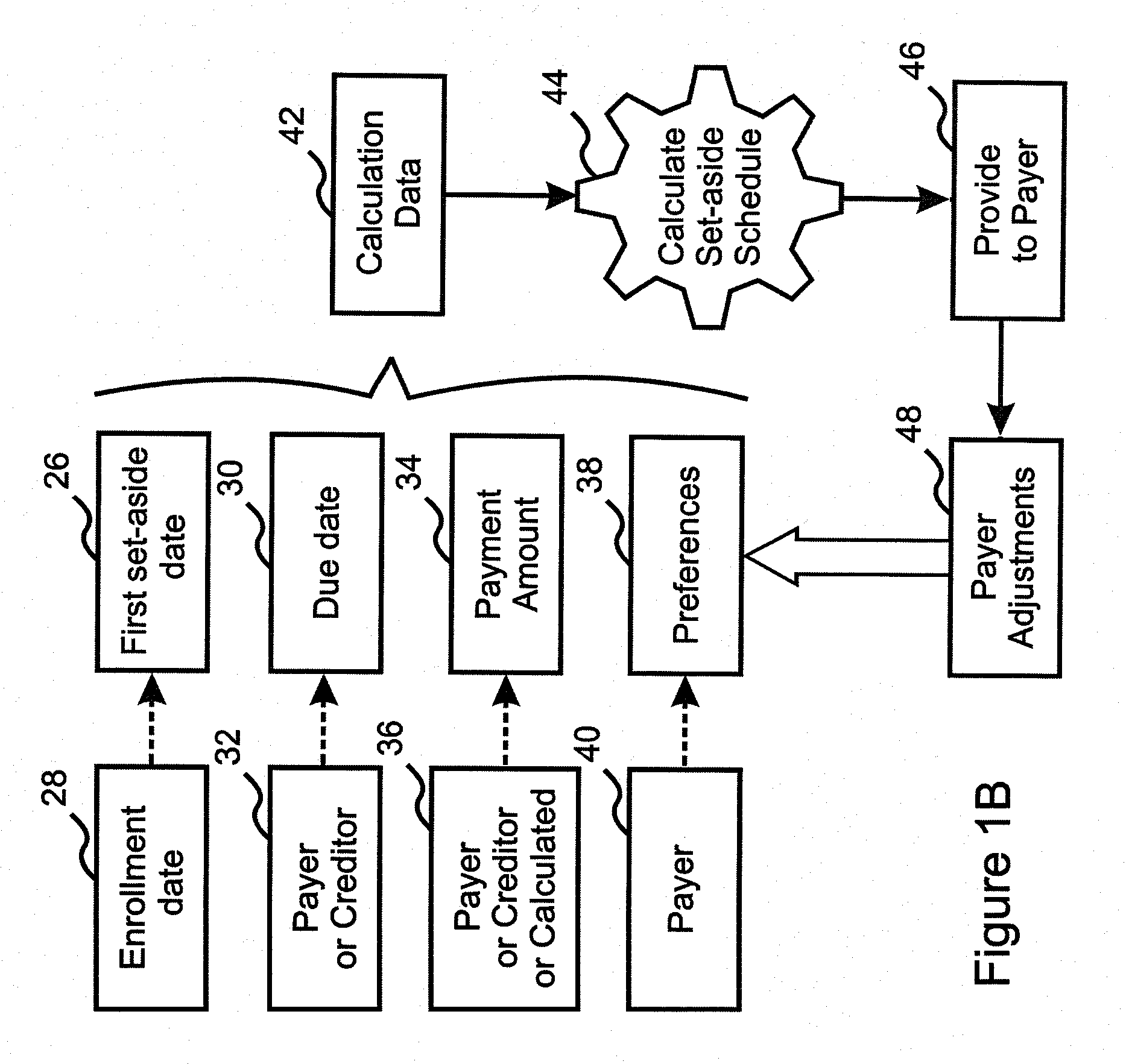

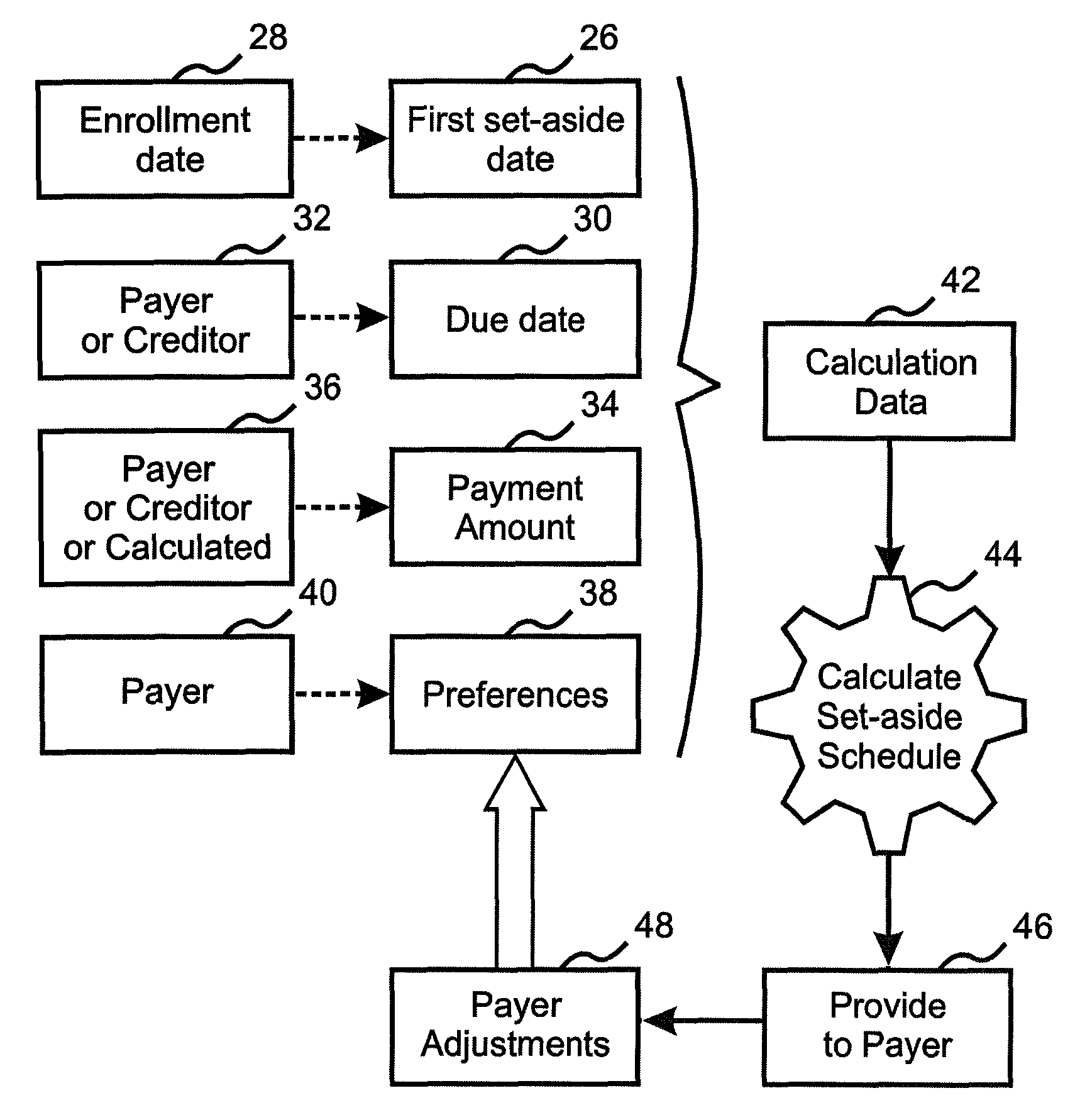

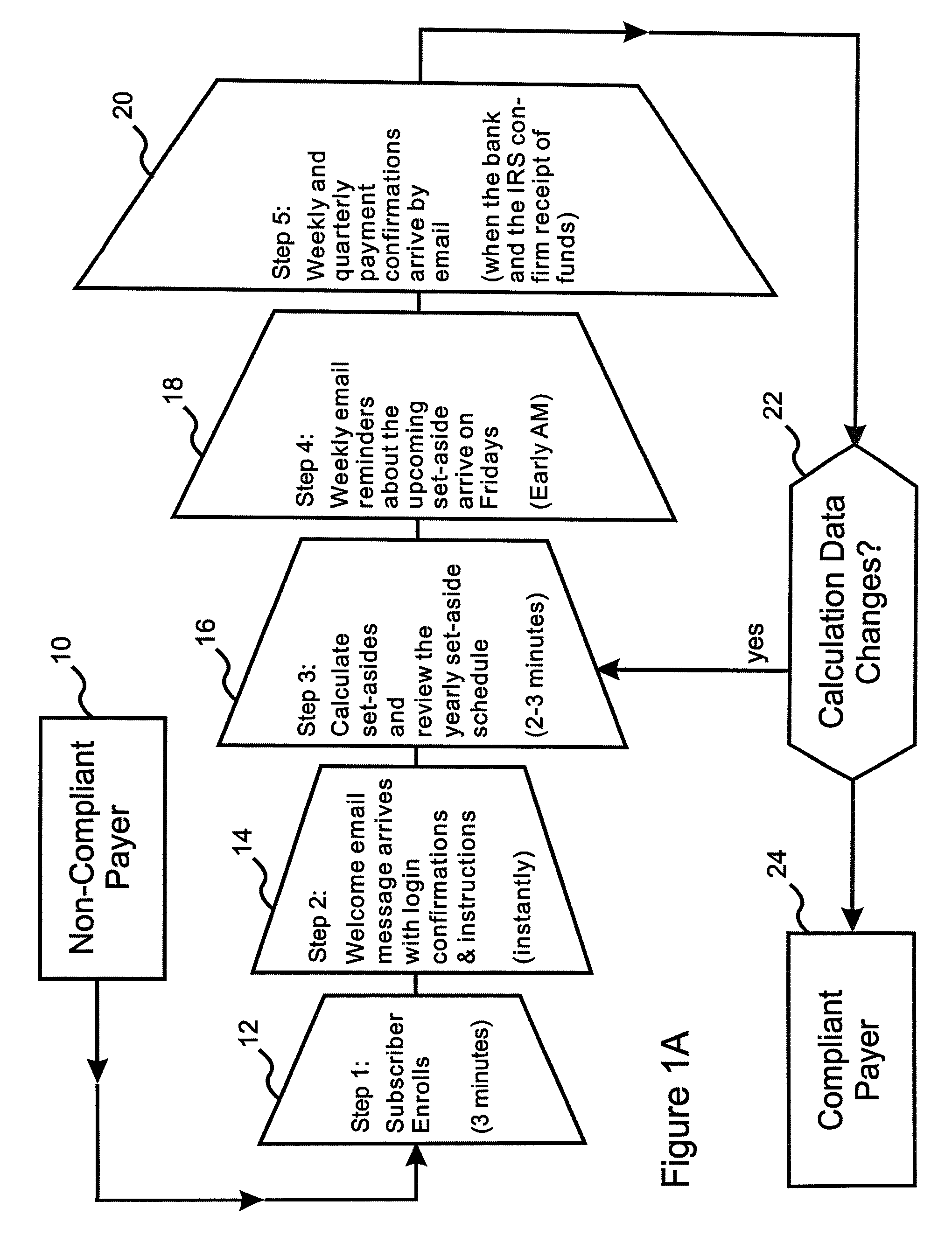

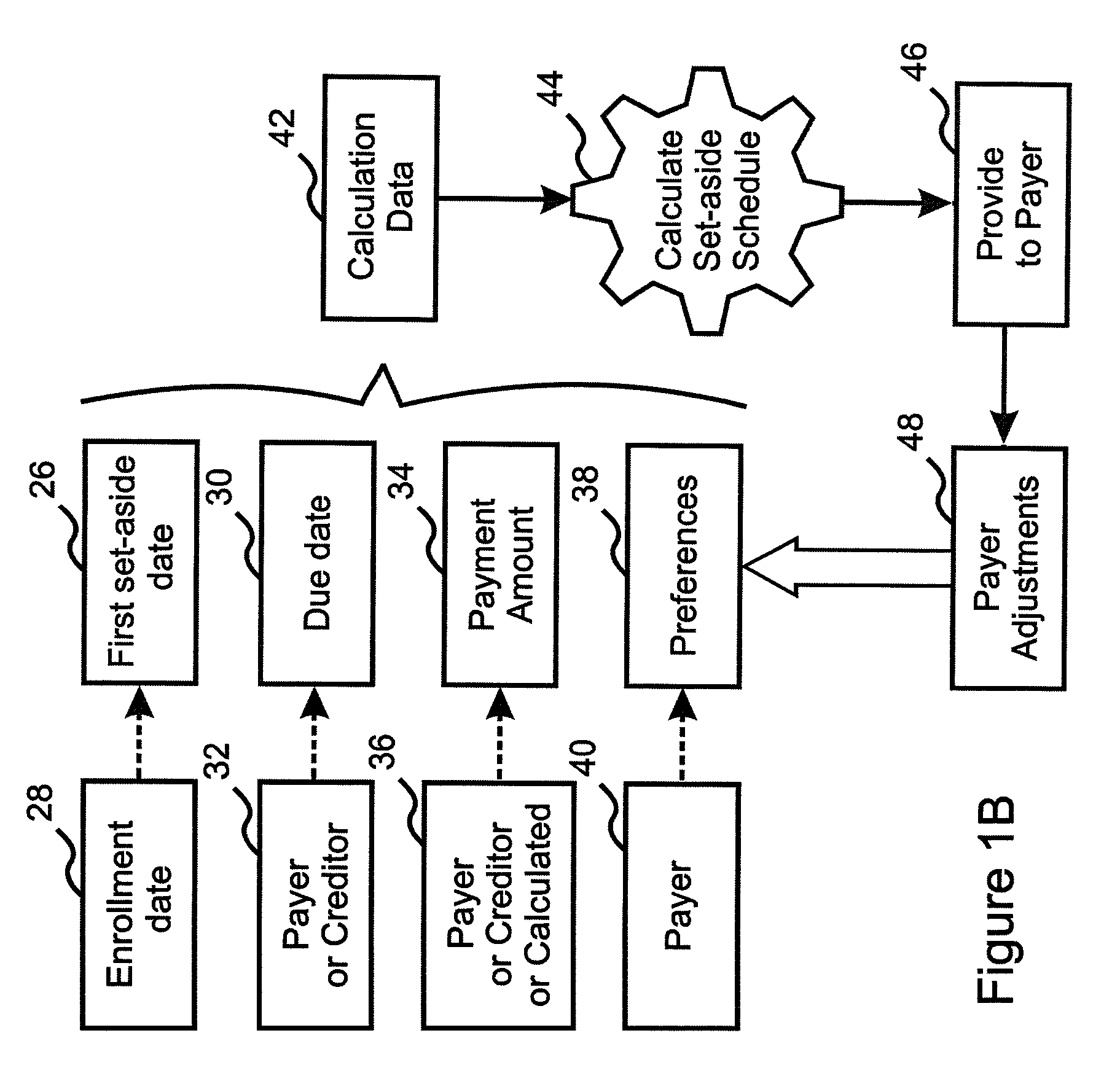

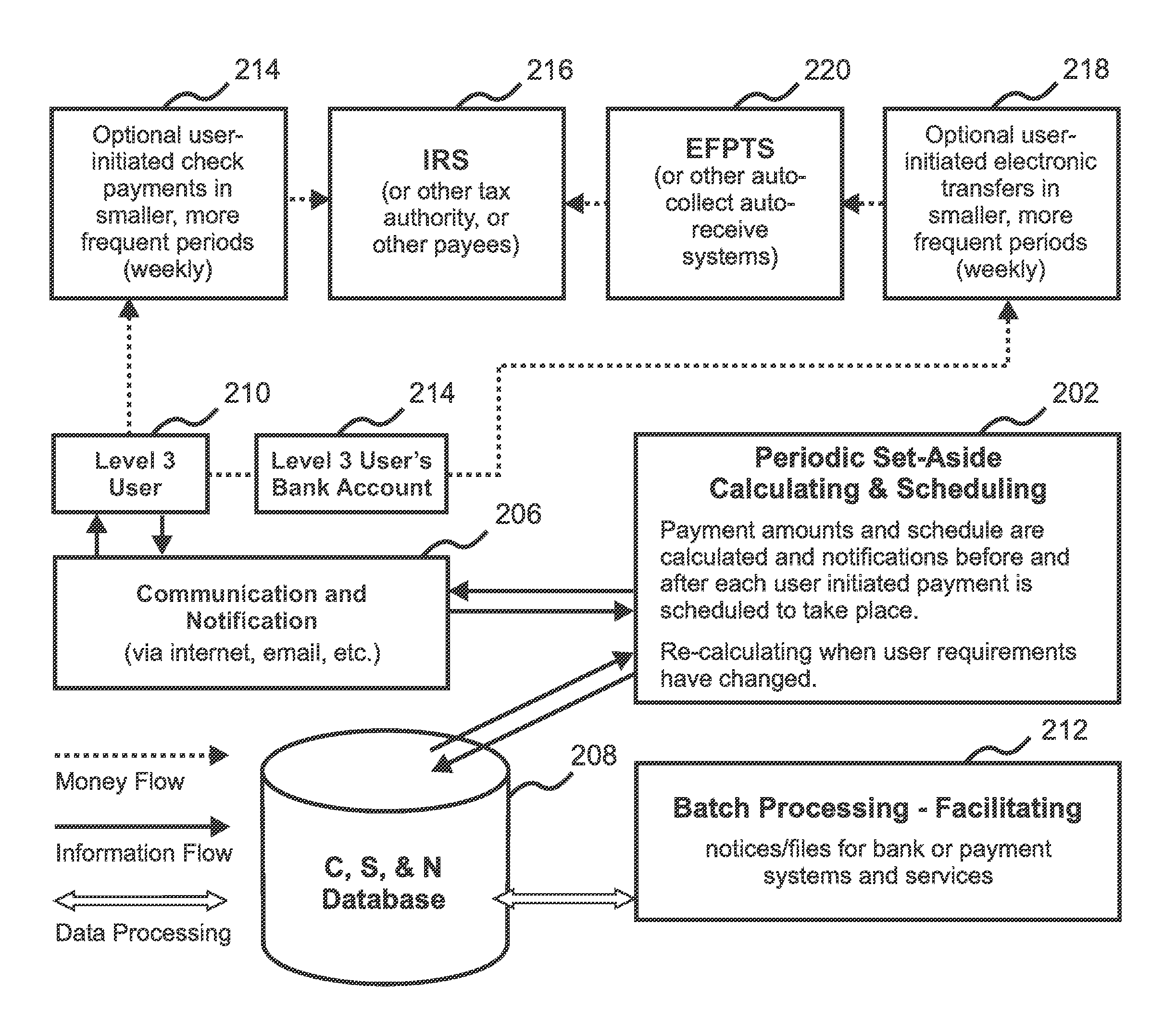

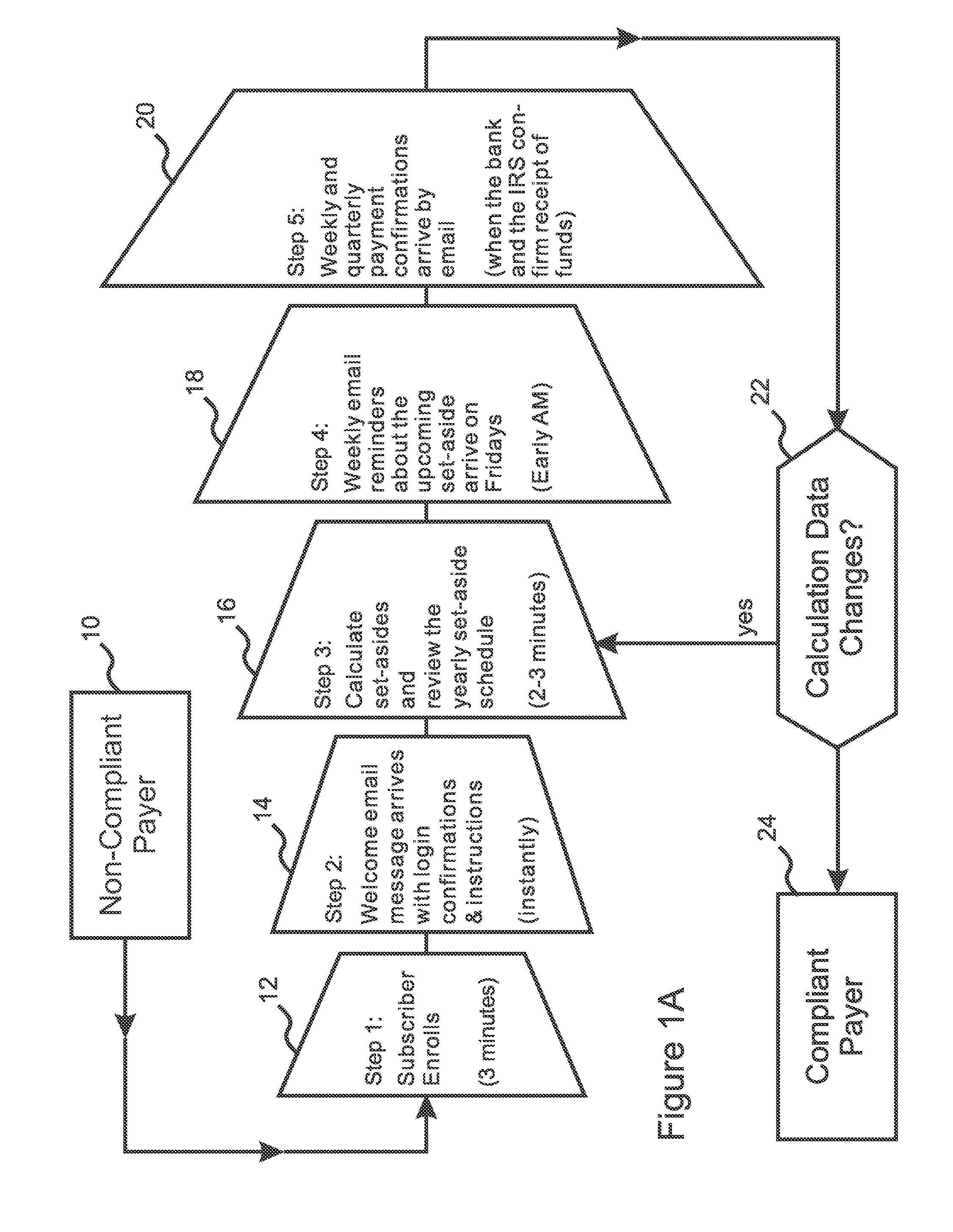

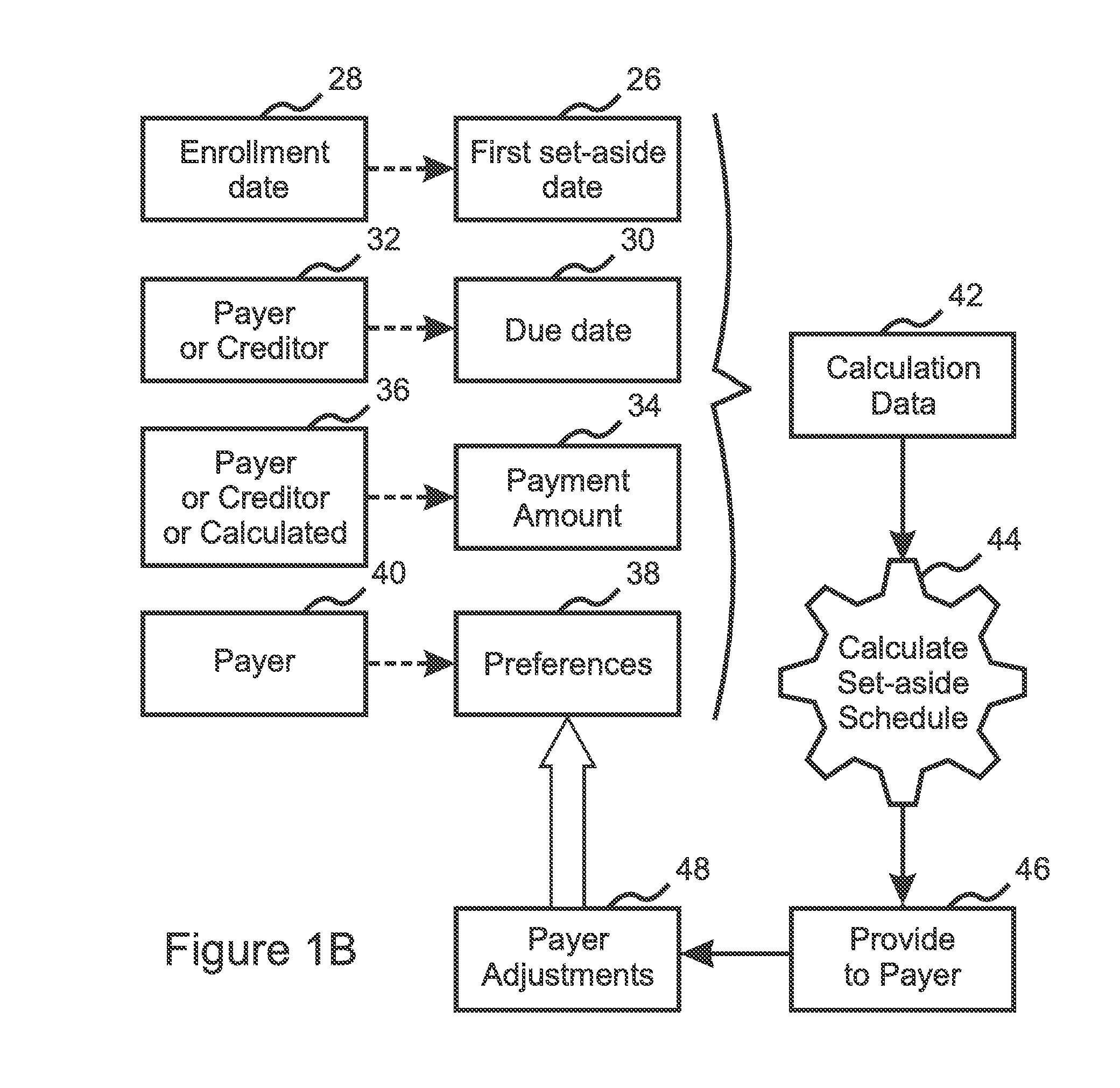

Flexible and adaptive accrual method and apparatus for calculating and facilitating compliance with taxes and other obligations

ActiveUS20120109793A1Avoid underpaymentMinimize overpaymentComplete banking machinesFinancePaymentTime schedule

A computer-based system and method calculates and facilitates periodic revenue accrual for making larger, less frequent payments of estimated taxes by electronic messaging. A service host enables a plurality of payers to make set-asides at various levels as needed, on an individual or batch basis. Payer preferences are applied to satisfy variable payment intervals, amounts, and available resources. The obligation, required payments, and set-aside schedules are recalculated as needed, under payer and / or system control. Excess accruals are minimized; set-aside schedules are configurable. Automatic data links move information and command fund transfers from the payer's bank, to accrue funds and make payments to other accounts. The service host provides individual or batch taxpayer enrollment with the taxing authority for tax payment by electronic messages, and makes the tax payments by transmission of individual payment messages or by batch file transmission to the taxing authority.

Owner:DYNATAX SOLUTIONS

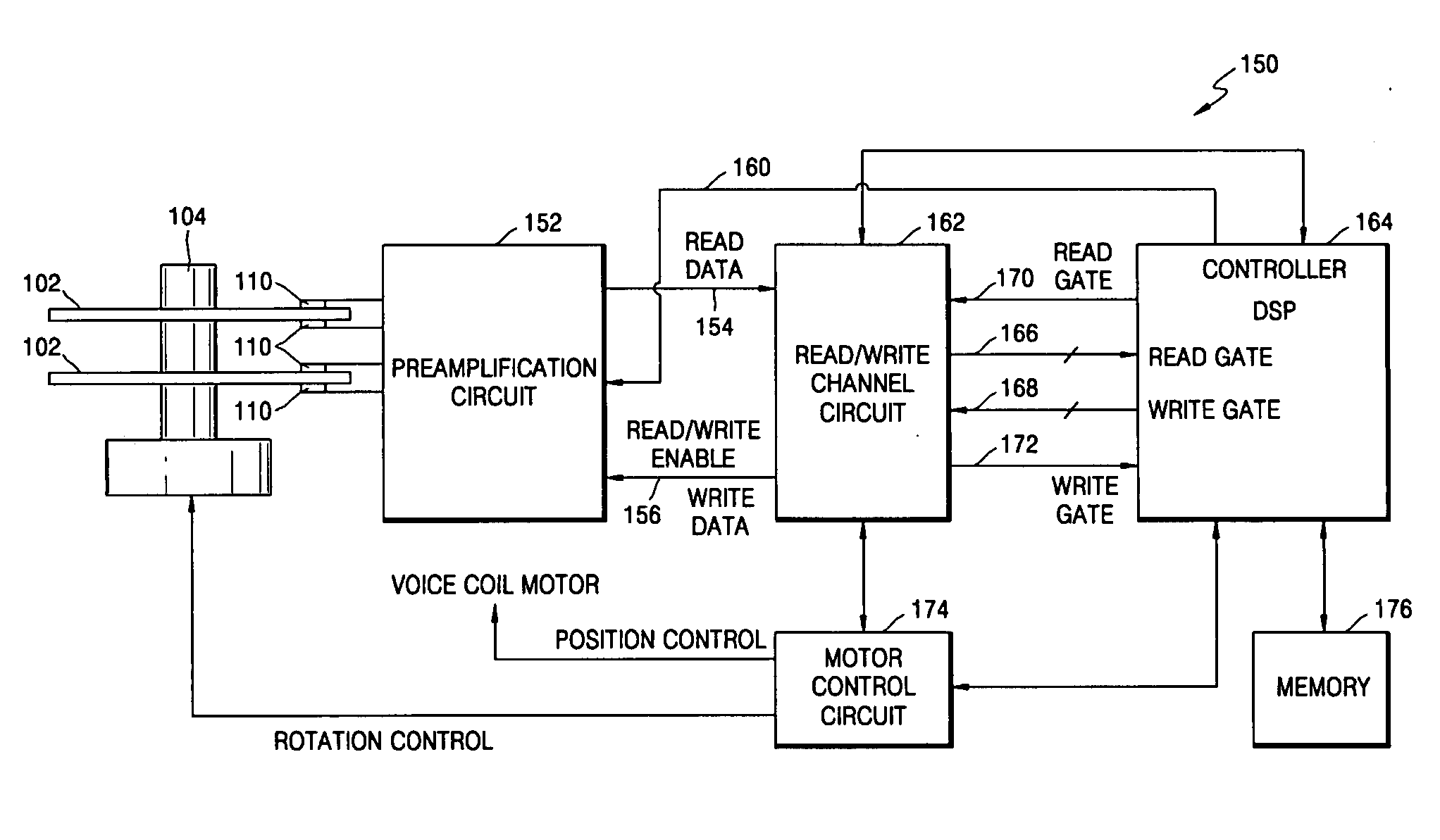

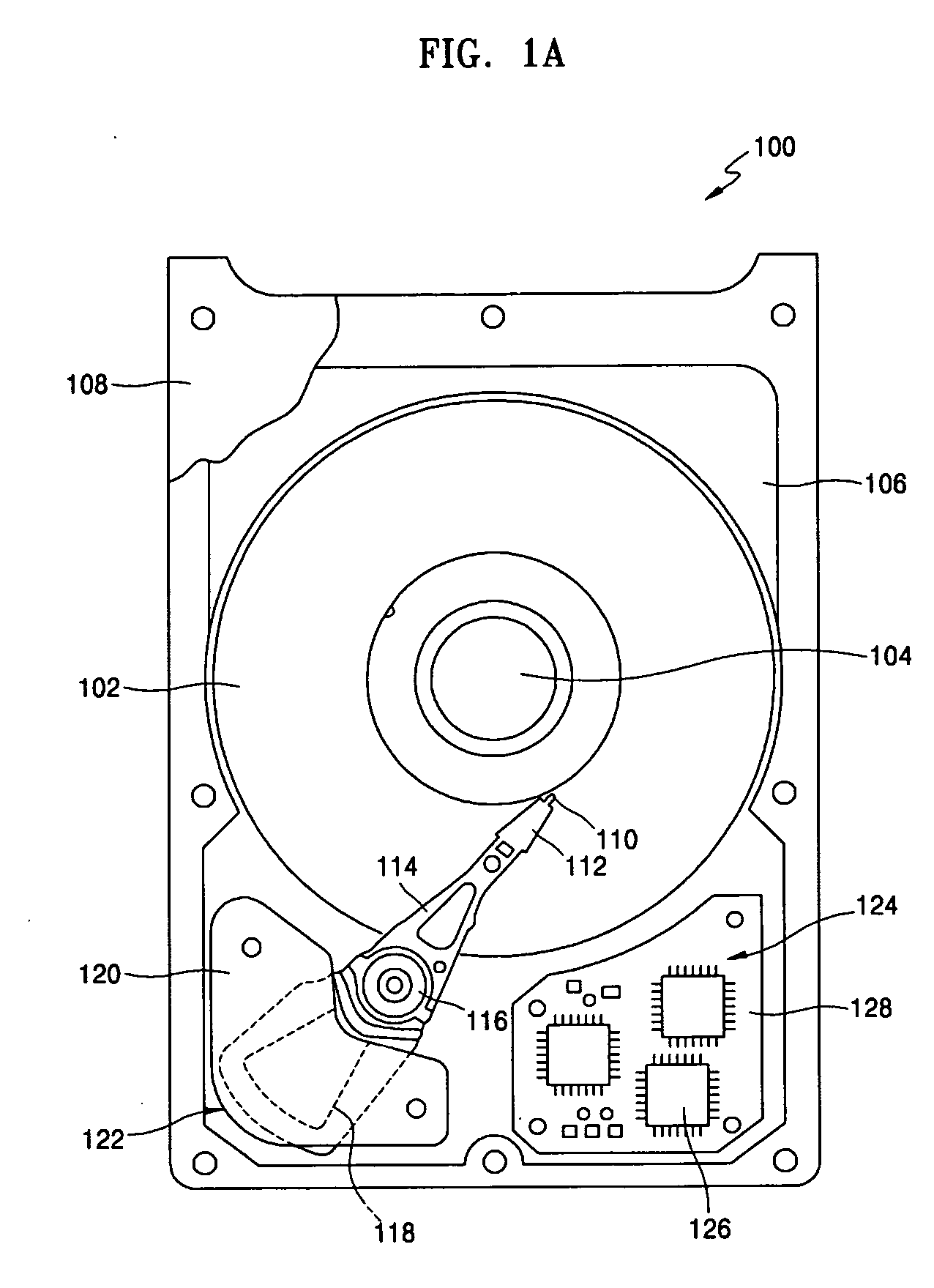

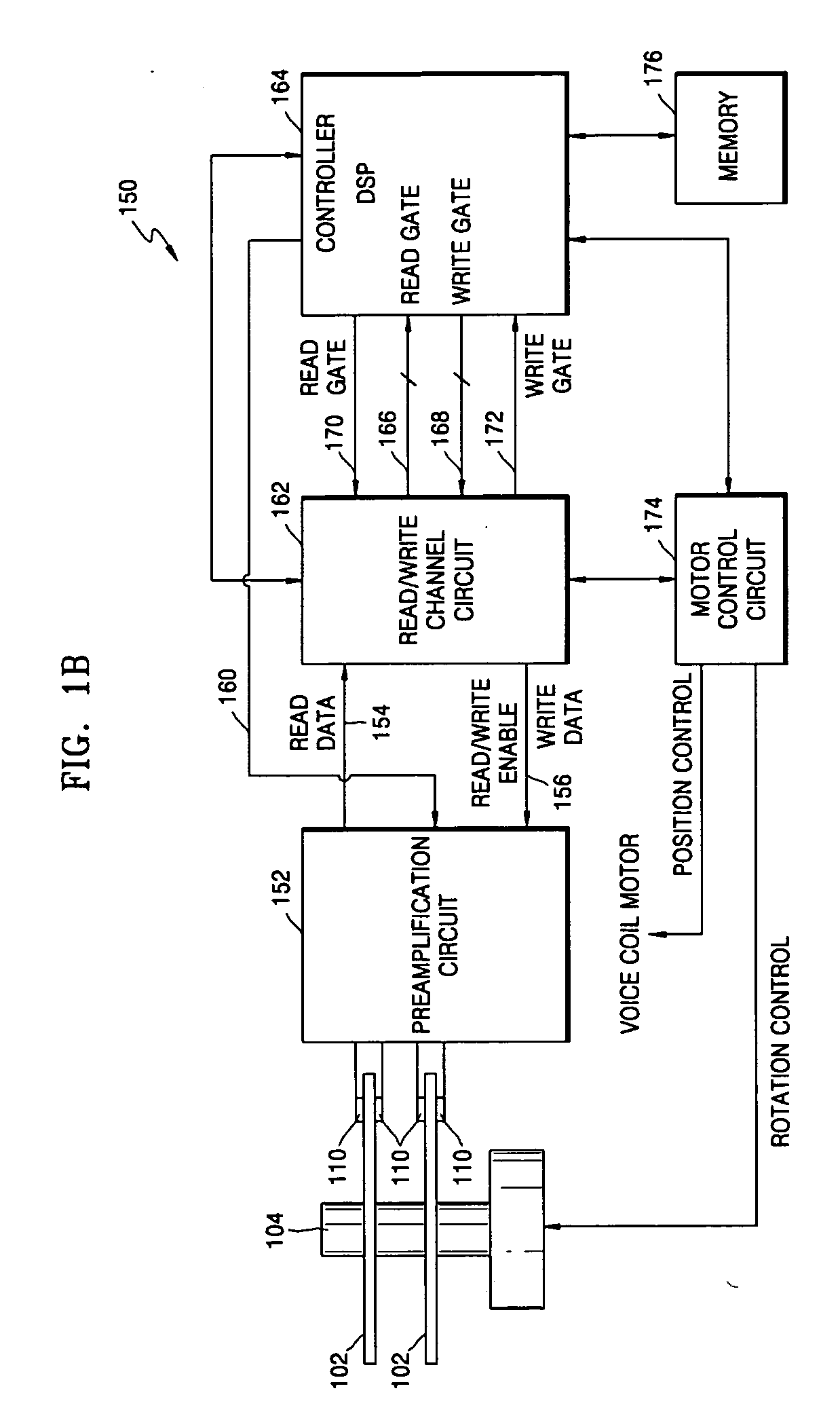

Method, medium, and apparatus transforming addresses of discs in a disc drive

InactiveUS20060190699A1Minimize fluctuationRecording carrier detailsDriving/moving recording headsComputer hardwareData transmission

A method, medium, and apparatus transforming a logical address of a disc. The method includes mapping a plurality of physical addresses to a plurality of logical addresses with reference to the data transmission speeds of the heads so that a physical address for a head having a higher data transmission speed is mapped to a relatively lower logical address, and transforming logical addresses of the disc drive into physical addresses with reference to the mapping results. Accordingly, it is possible to minimize fluctuations in the data transmission speed of the disc drive whenever the disc drive switches heads.

Owner:SAMSUNG ELECTRONICS CO LTD

Ink-feeding device and pressure-generating method

InactiveUS20080273064A1Quality improvementNegative pressure fluctuatesPrintingInternal pressureEngineering

An ink-feeding device is provided in which the pressure applied to the ink in the printing head can be adjusted arbitrarily irrespective of the relative positions of the ink container and the printing head. Inside the sub-tank 80, a pressure-adjusting pump 82 is installed for applying a suitable pressure to many nozzles 22Kn of the printing head 22K. This pressure-adjusting pump 82 is placed a little above the bottom face of the sub-tank 80 at a prescribed distance from the bottom face. Thereby the pressure-adjusting pump 82 is immersed in the ink held in the sub-tank 80. A drive unit 83 for driving the pressure-adjusting pump 82 is placed above the sub-tank 80. On the upper wall of the sub-tank 80, an air-vent valve 84 is fixed to bring the inside pressure in the sub-tank 80 to an atmospheric pressure. The inside pressure in the sub-tank 80 is made equal to the atmospheric pressure by opening the air-vent valve 84.

Owner:COPYER

Flexible and adaptive accrual method and apparatus for calculating and facilitating compliance with taxes and other obligations

ActiveUS20100036760A1Avoid underpaymentMinimize fluctuationComplete banking machinesFinanceTime schedulePayment

A computer-based system and method calculates and facilitates revenue accrual, for making larger, less frequent payments of estimated taxes or other obligations. Payer preferences are applied to satisfy variable payment intervals, amounts, and available resources. The obligation, required payments, and set-aside schedules are recalculated as needed, under payer and / or system control. Excess accruals are minimized; set-aside schedules are configurable. The system may be self-contained, handheld, or accessed remotely. Automatic datalinks move information and command fund transfers from the payer's bank, to accrue funds and make payments to other accounts. A service host may support a plurality of payers to make set-asides and payments at various levels as needed, on an individual or batch basis, including individual taxpayer enrollment for batch file tax payments by service providers. Some embodiments can be embedded to enhance the capabilities of other systems.

Owner:DYNATAX SOLUTIONS

Flexible and adaptive accrual method and apparatus for calculating and facilitating compliance with taxes and other obligations

ActiveUS7912768B2Avoid underpaymentMinimize fluctuationComplete banking machinesFinancePaymentService provision

A computer-based system and method calculates and facilitates revenue accrual, for making larger, less frequent payments of estimated taxes or other obligations. Payer preferences are applied to satisfy variable payment intervals, amounts, and available resources. The obligation, required payments, and set-aside schedules are recalculated as needed, under payer and / or system control. Excess accruals are minimized; set-aside schedules are configurable. The system may be self-contained, handheld, or accessed remotely. Automatic datalinks move information and command fund transfers from the payer's bank, to accrue funds and make payments to other accounts. A service host may support a plurality of payers to make set-asides and payments at various levels as needed, on an individual or batch basis, including individual taxpayer enrollment for batch file tax payments by service providers. Some embodiments can be embedded to enhance the capabilities of other systems.

Owner:DYNATAX SOLUTIONS

Flexible and adaptive accrual method and apparatus for calculating and facilitating compliance with taxes and other obligations

ActiveUS8560409B2Avoid underpaymentMinimize fluctuationComplete banking machinesFinancePaymentComputer science

A computer-based system and method calculates and facilitates periodic revenue accrual for making larger, less frequent payments of estimated taxes by electronic messaging. A service host enables a plurality of payers to make set-asides at various levels as needed, on an individual or batch basis. Payer preferences are applied to satisfy variable payment intervals, amounts, and available resources. The obligation, required payments, and set-aside schedules are recalculated as needed, under payer and / or system control. Excess accruals are minimized; set-aside schedules are configurable. Automatic data links move information and command fund transfers from the payer's bank, to accrue funds and make payments to other accounts. The service host provides individual or batch taxpayer enrollment with the taxing authority for tax payment by electronic messages, and makes the tax payments by transmission of individual payment messages or by batch file transmission to the taxing authority.

Owner:DYNATAX SOLUTIONS

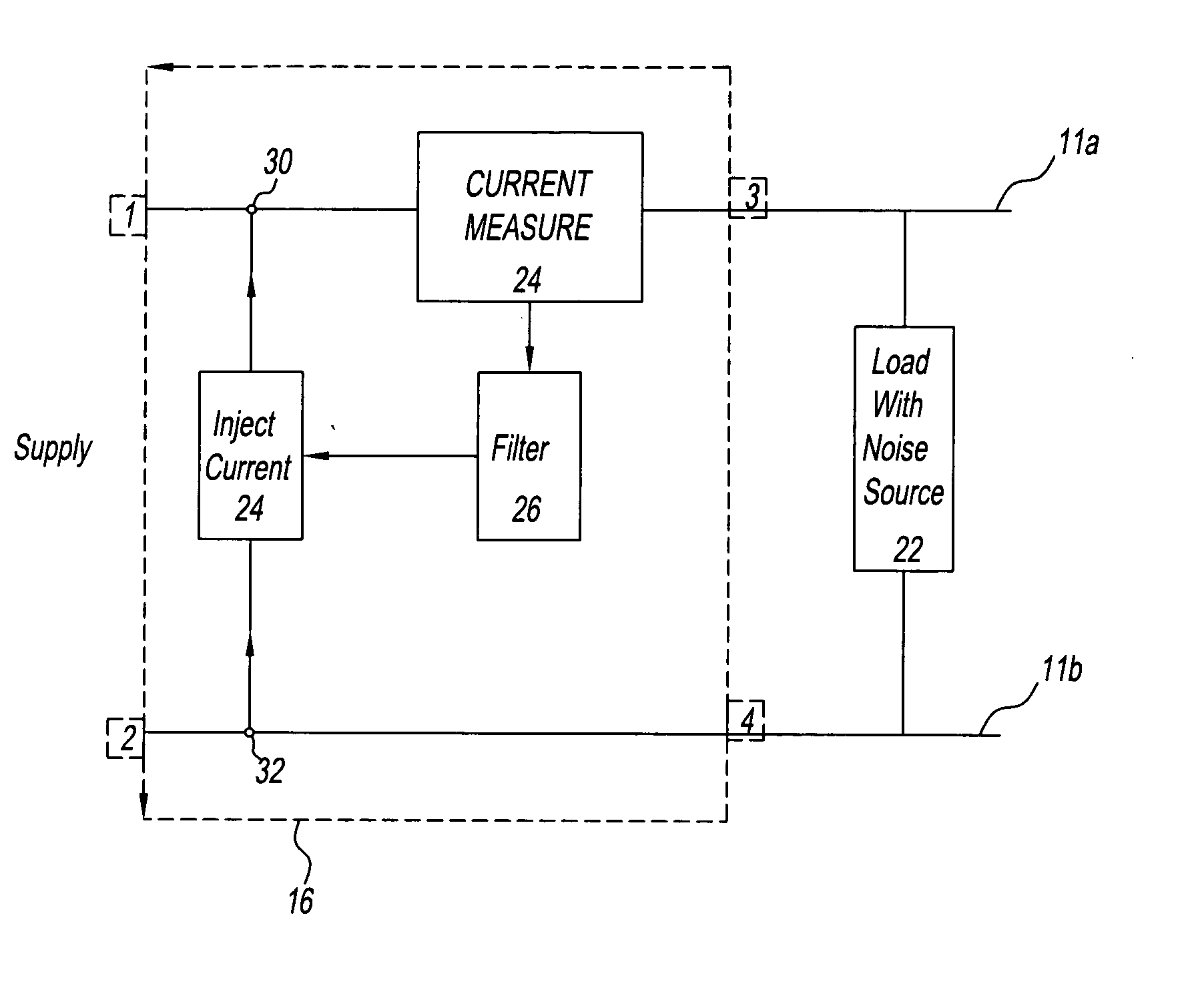

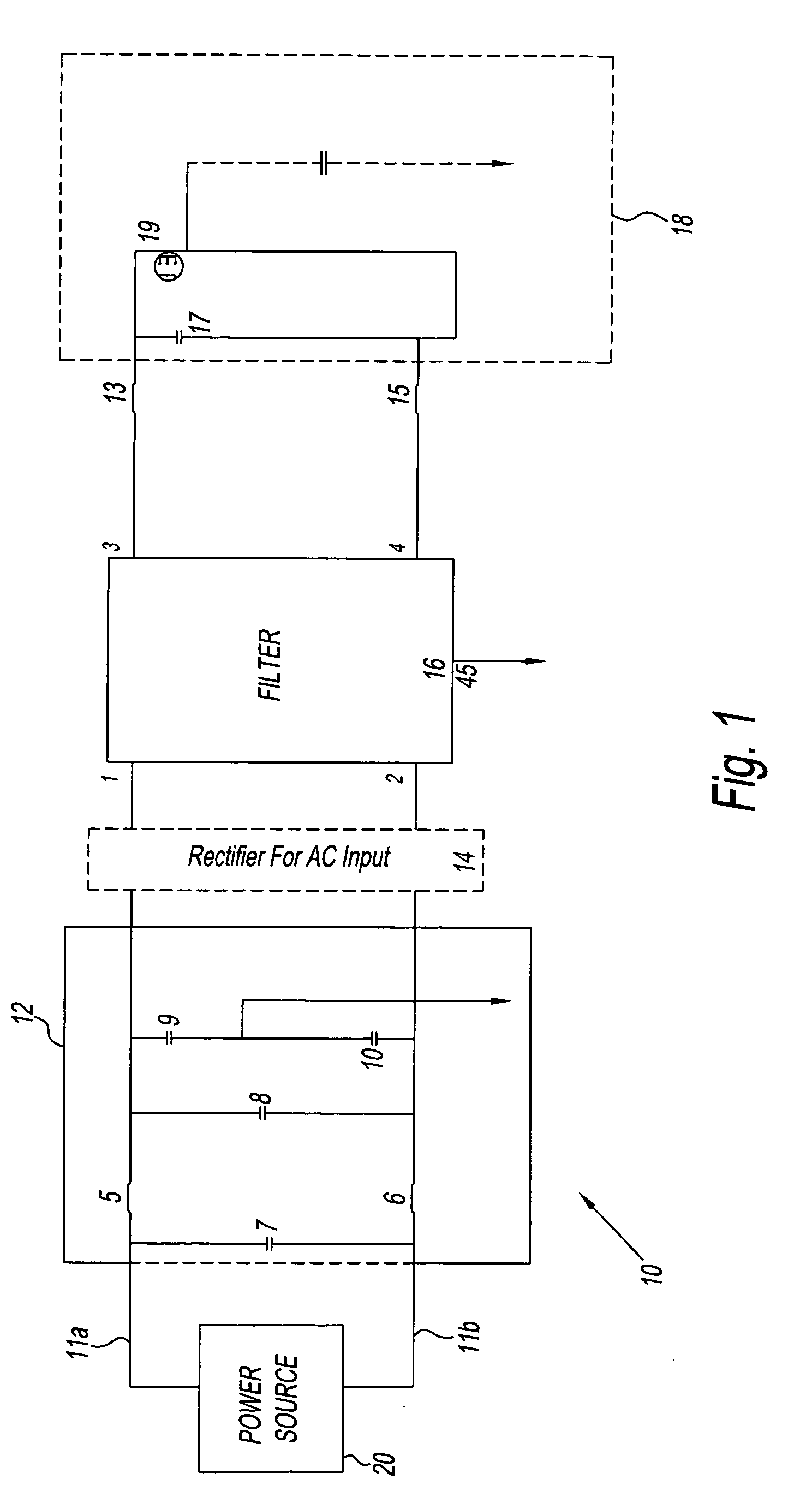

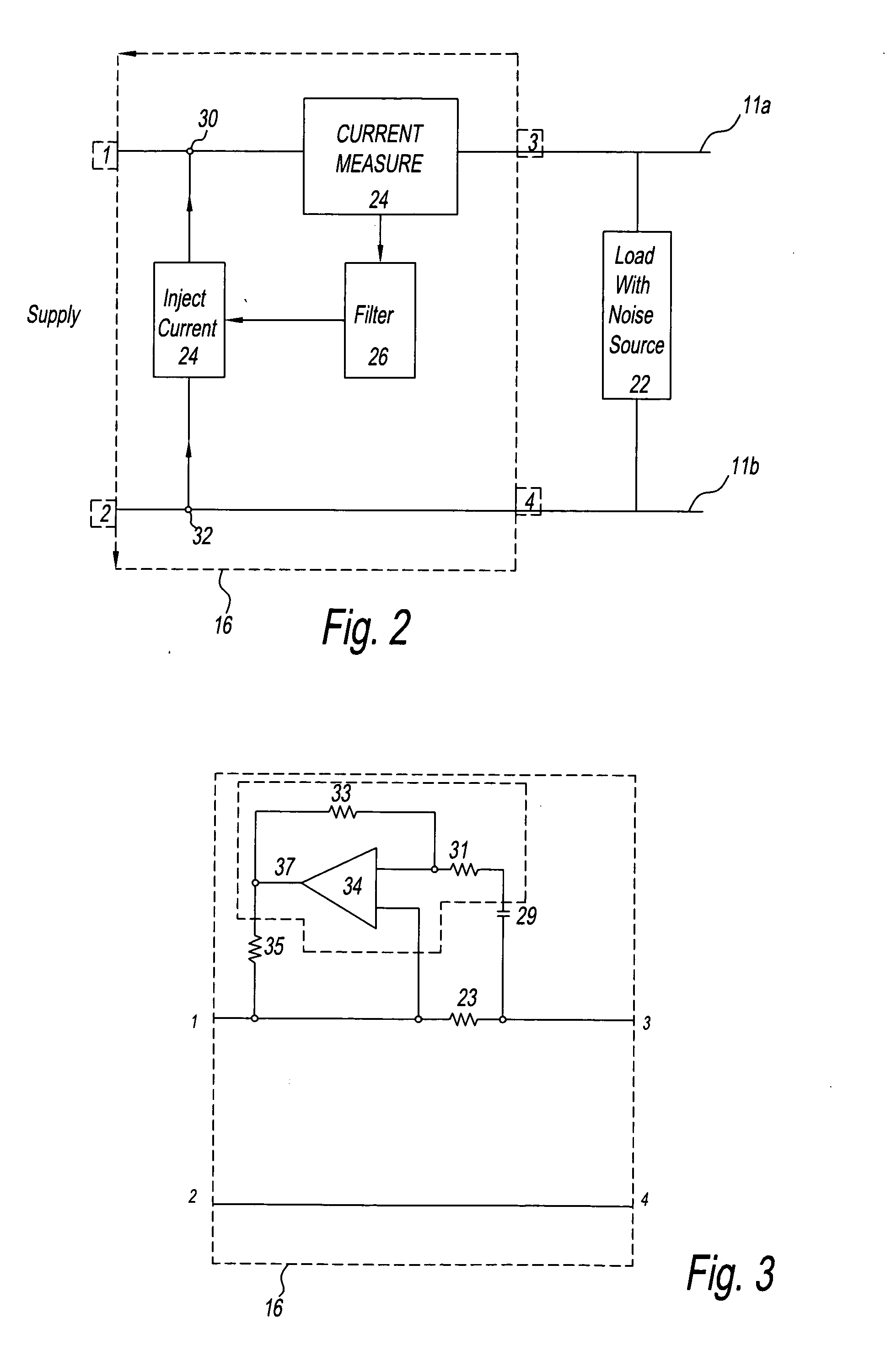

Apparatus and method for improving electromagnetic compatibility

ActiveUS20050280405A1Improve electromagnetic compatibilityMinimize fluctuationImpedence networksElectric variable regulationElectromagnetic compatibilityInjector

Owner:VIAVI SOLUTIONS INC

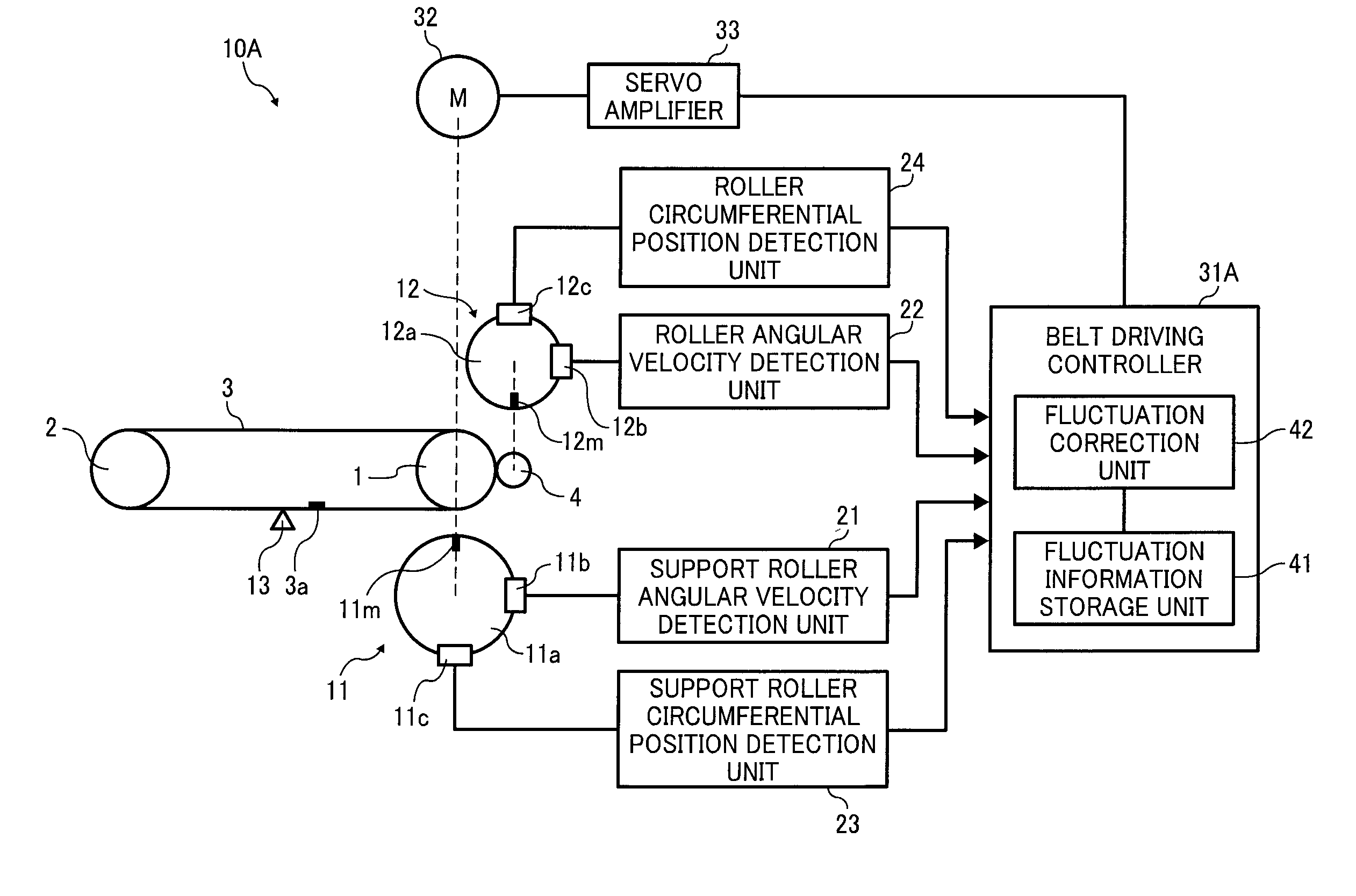

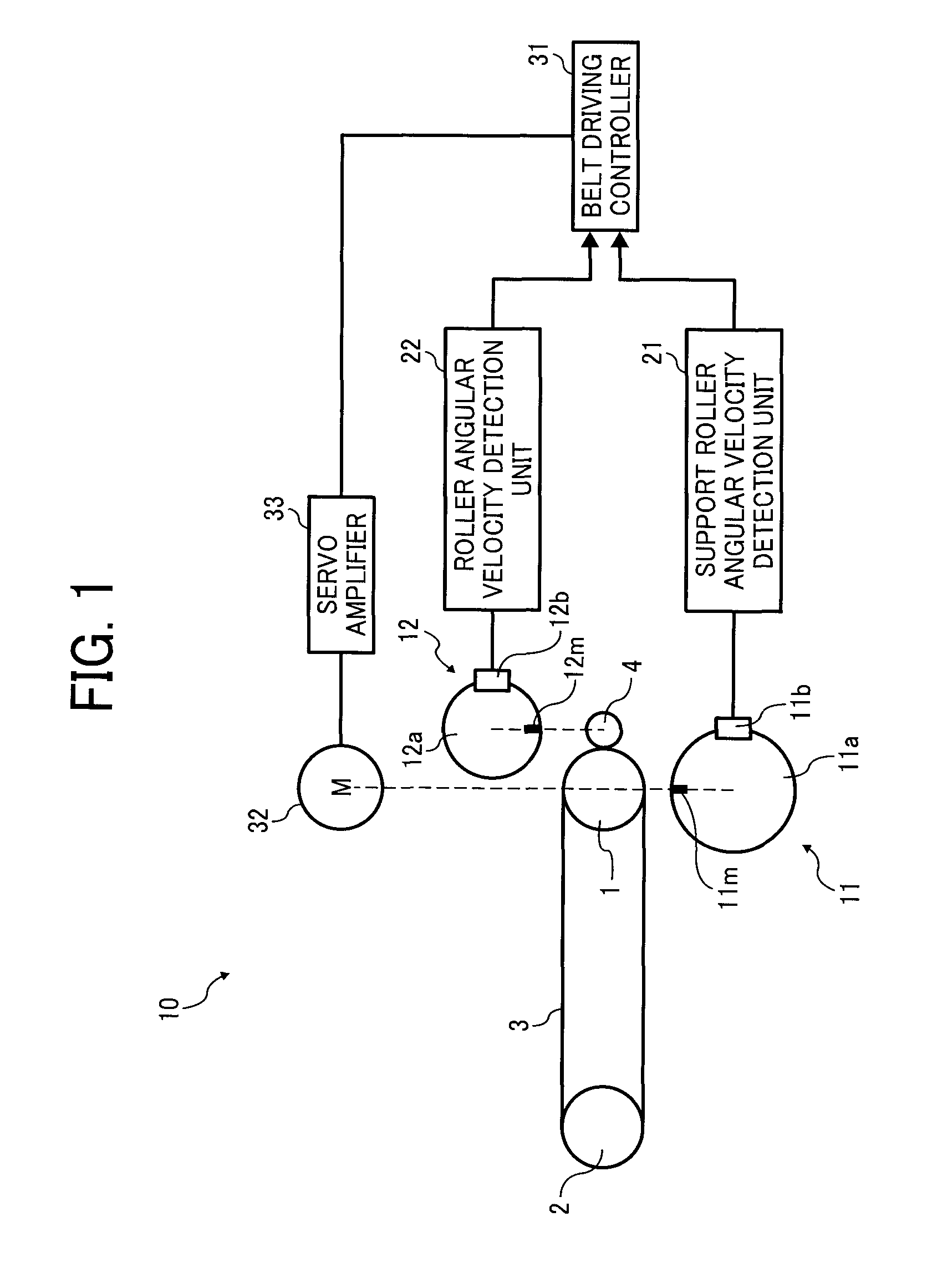

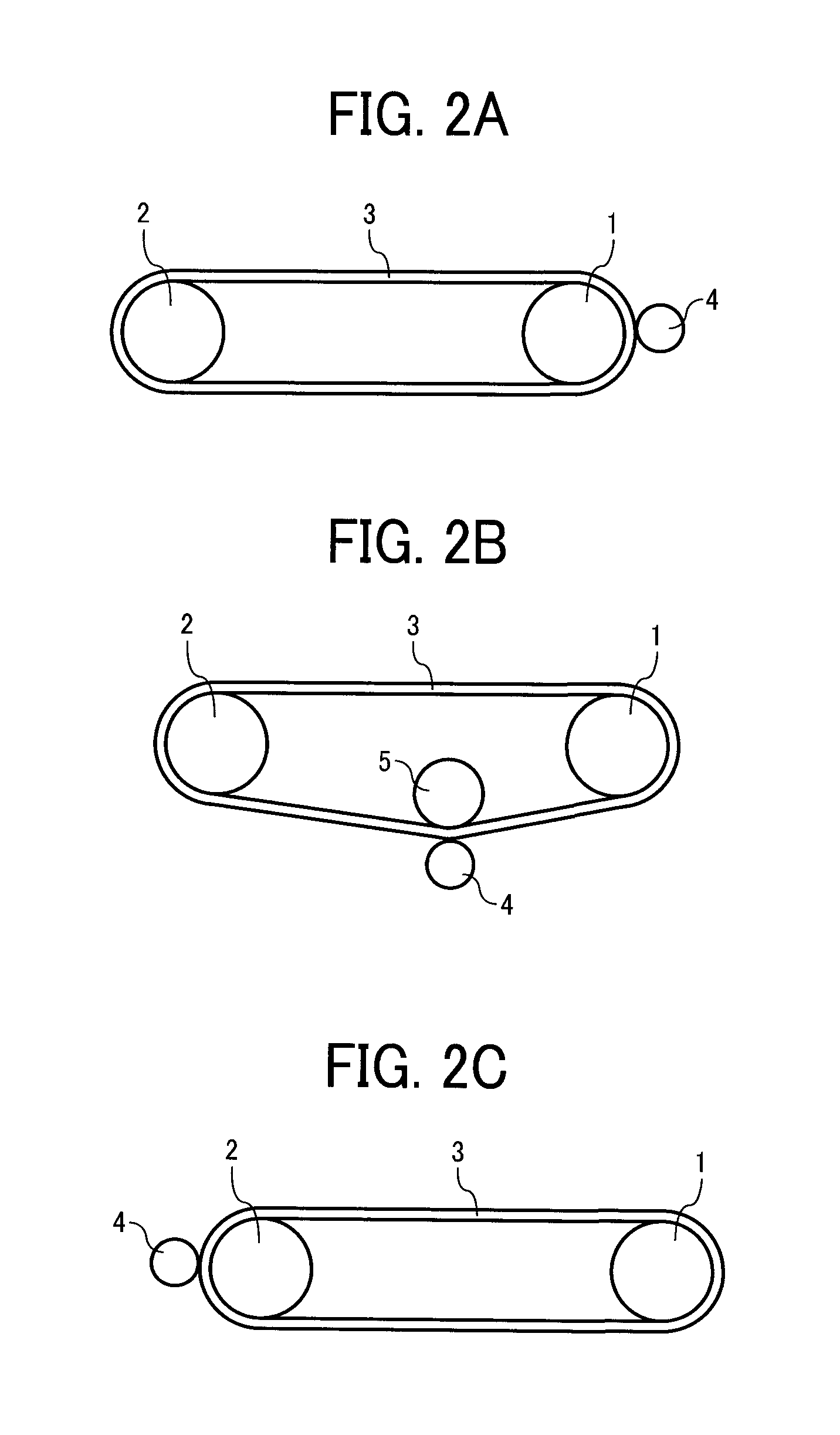

Image forming apparatus, belt unit, and belt driving control method

An image forming apparatus for forming an image on a recording medium includes a belt configured to travel rotationally and looped around at least two rotary support members, a driven rotary member disposed facing at least one of the rotary support members via the belt and configured to rotate with the belt, and a controller. The controller is configured to minimize fluctuation in one of a travel velocity and a travel distance of the belt by controlling the travel of the belt based on one of a rotational angular displacement and a rotational angular velocity of each of the rotary support member and the driven rotary member.

Owner:RICOH KK

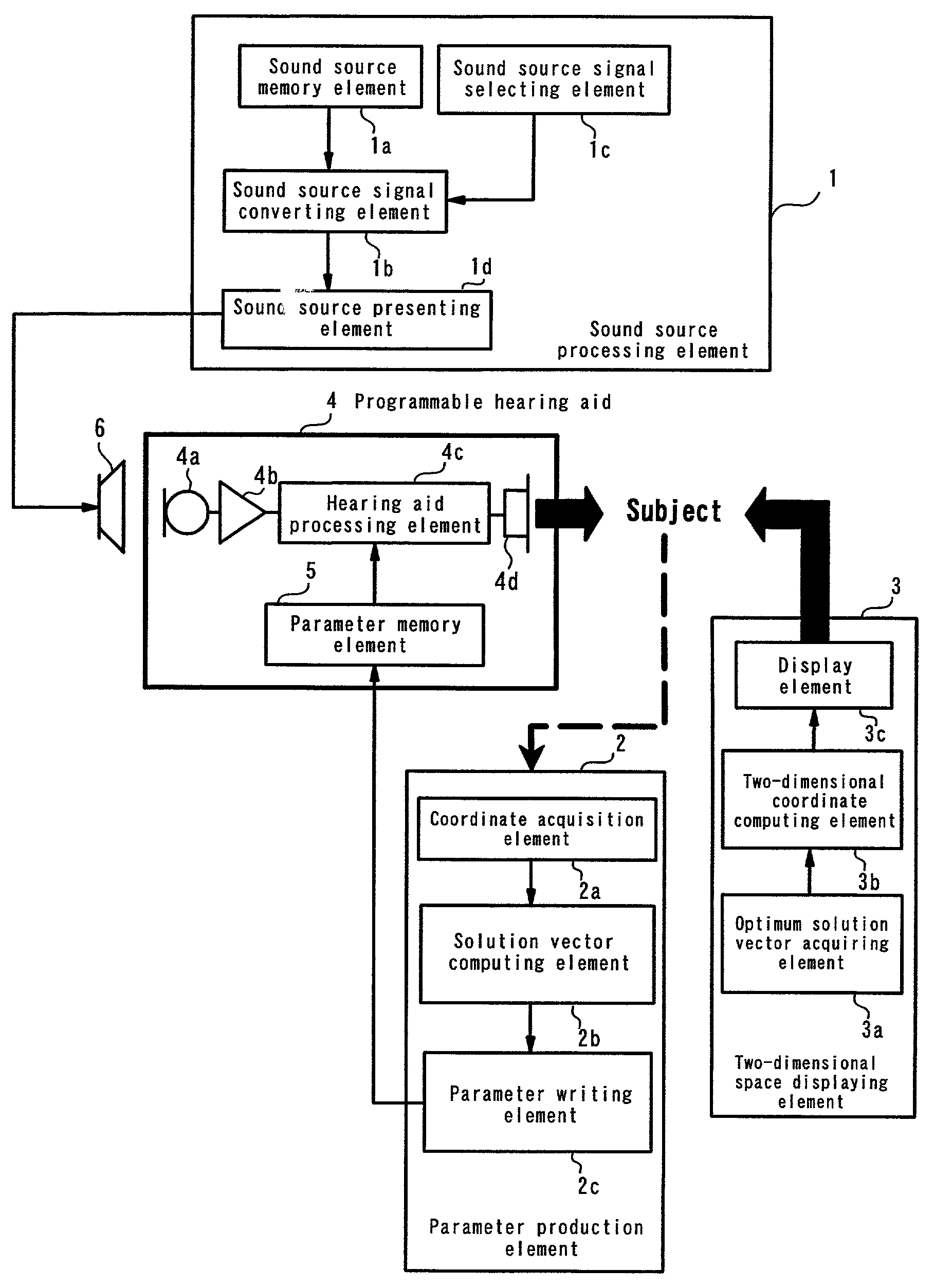

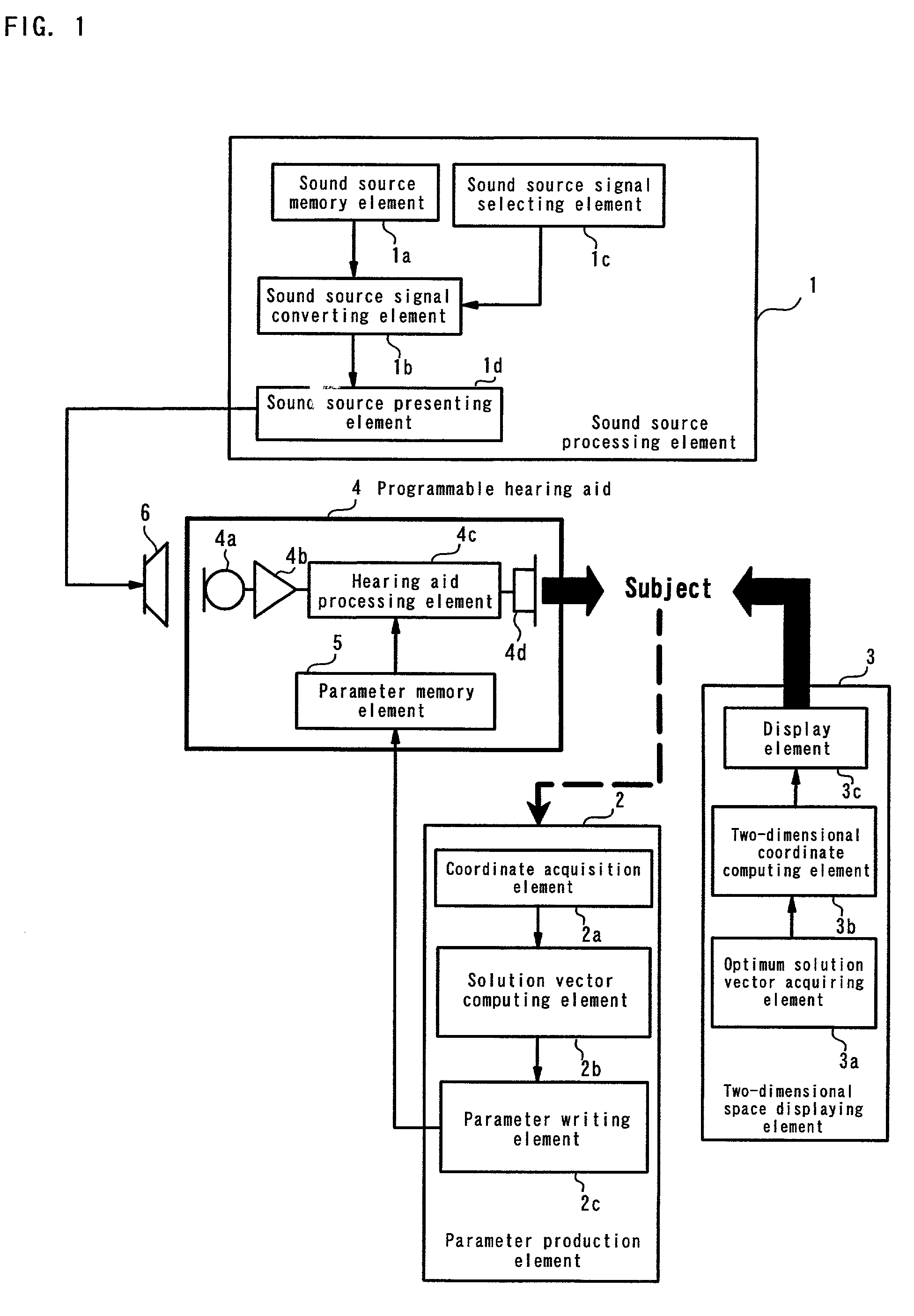

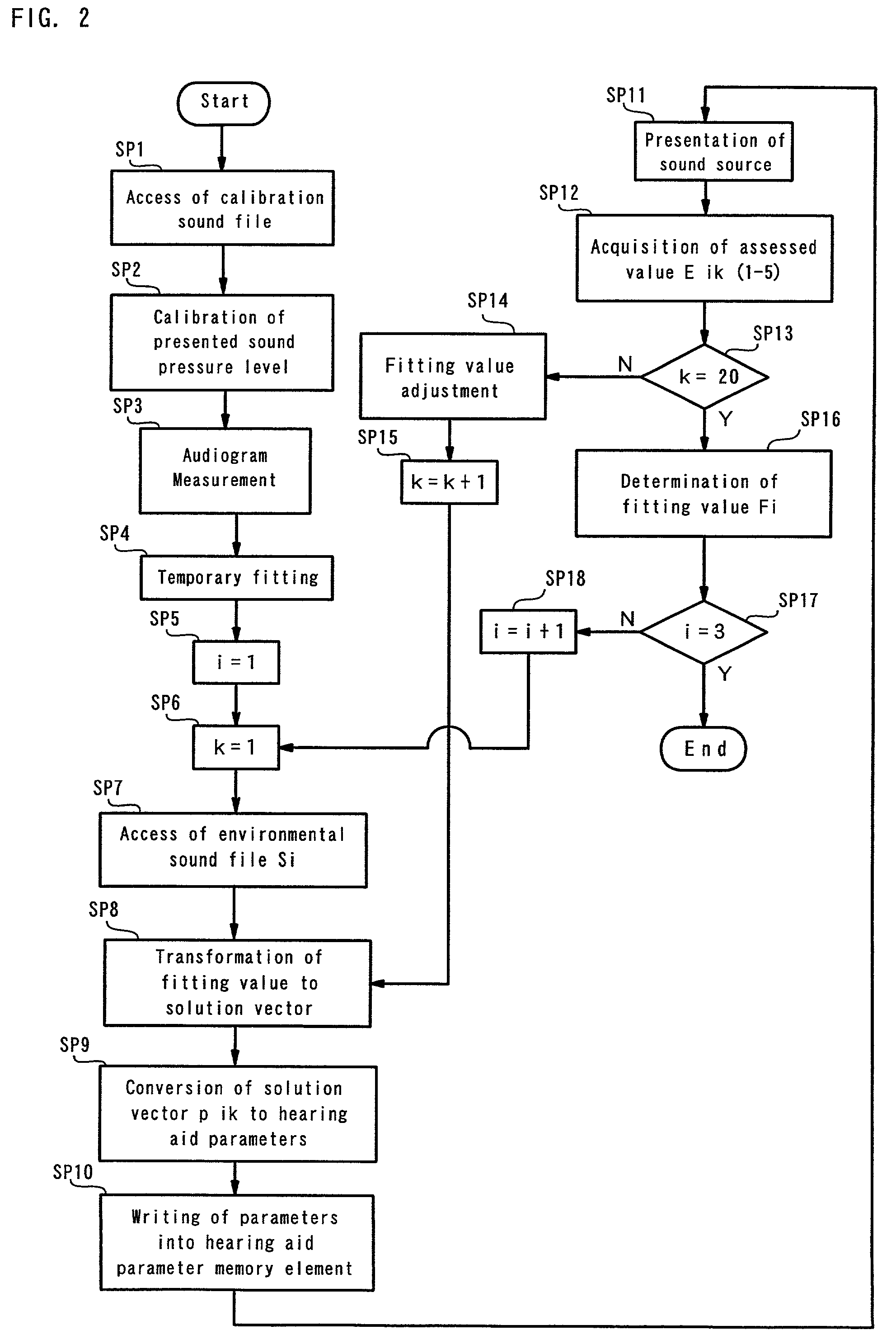

Optimum solution method, hearing aid fitting apparatus utilizing the optimum solution method, and system optimization adjusting method and apparatus

A parameter writing element converts a solution vector found by an optimum solution method that determines optimum n-dimensional solution vector, based on a plurality of optimum n-dimensional solution vector candidates to an adjustment parameter values of a programmable hearing aid and writes the adjustment parameter values into a hearing aid parameter memory element of the programmable hearing aid using a sound source memory element for storing a sound source, and a sound source presenting element for presenting the sound source to the programmable hearing aid.

Owner:RION COMPANY

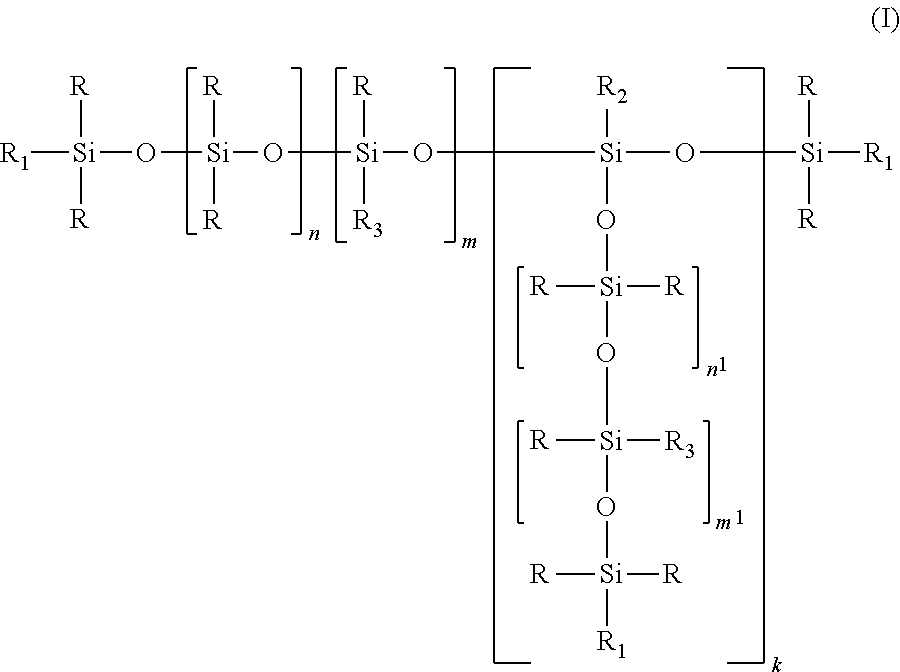

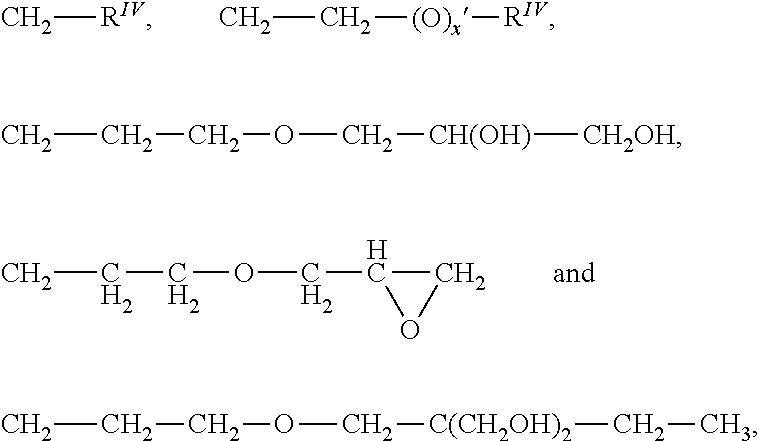

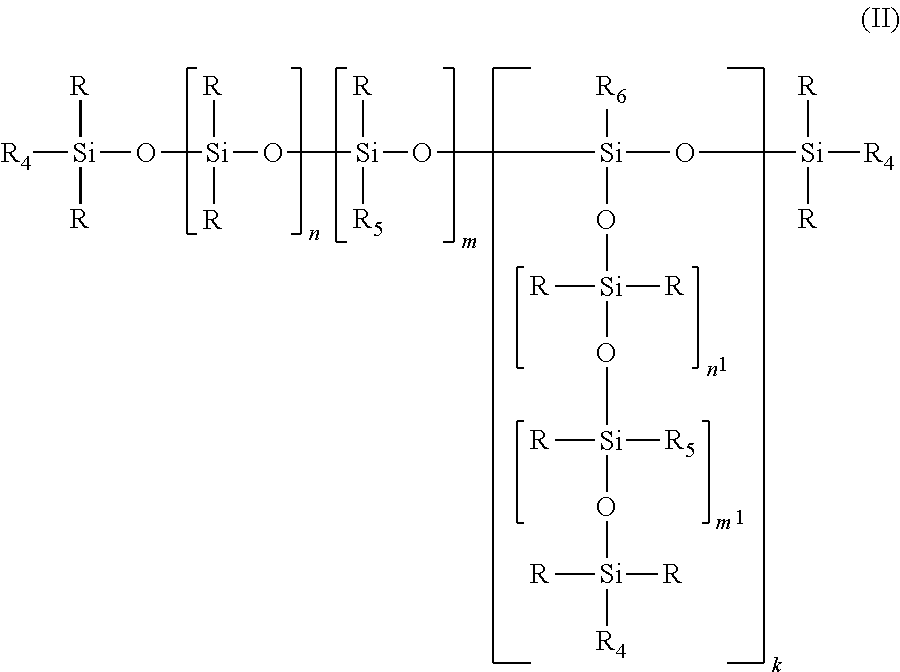

Silicone-polyether block copolymers with high molecular weight polyether residues and their use as stabilizers for production of polyurethane foams

InactiveUS20120190760A1Improve foam stabilityGood cell finenessAntifouling/underwater paintsPaints with biocidesCopolymerStabilizing Agents

Silicone-polyether block copolymer comprising a polyorganosiloxane which includes at least one polyether residue having a molecular weight of not less than 5000 g / mol, and wherein a weight average molecular weight of all polyether residues attached to the polyorganosiloxane by a chemical bond is above 3000 g / mol, its production and use and also compositions and polymeric articles obtained therewith.

Owner:EVONIK DEGUSSA GMBH

Ink-feeding device and pressure-generating method

InactiveUS7874656B2Quality improvementNegative pressure fluctuatesPrintingInternal pressureAtmospheric pressure

An ink-feeding device is provided in which the pressure applied to the ink in the printing head can be adjusted arbitrarily irrespective of the relative positions of the ink container and the printing head. Inside the sub-tank 80, a pressure-adjusting pump 82 is installed for applying a suitable pressure to many nozzles 22Kn of the printing head 22K. This pressure-adjusting pump 82 is placed a little above the bottom face of the sub-tank 80 at a prescribed distance from the bottom face. Thereby the pressure-adjusting pump 82 is immersed in the ink held in the sub-tank 80. A drive unit 83 for driving the pressure-adjusting pump 82 is placed above the sub-tank 80. On the upper wall of the sub-tank 80, an air-vent valve 84 is fixed to bring the inside pressure in the sub-tank 80 to an atmospheric pressure. The inside pressure in the sub-tank 80 is made equal to the atmospheric pressure by opening the air-vent valve 84.

Owner:COPYER

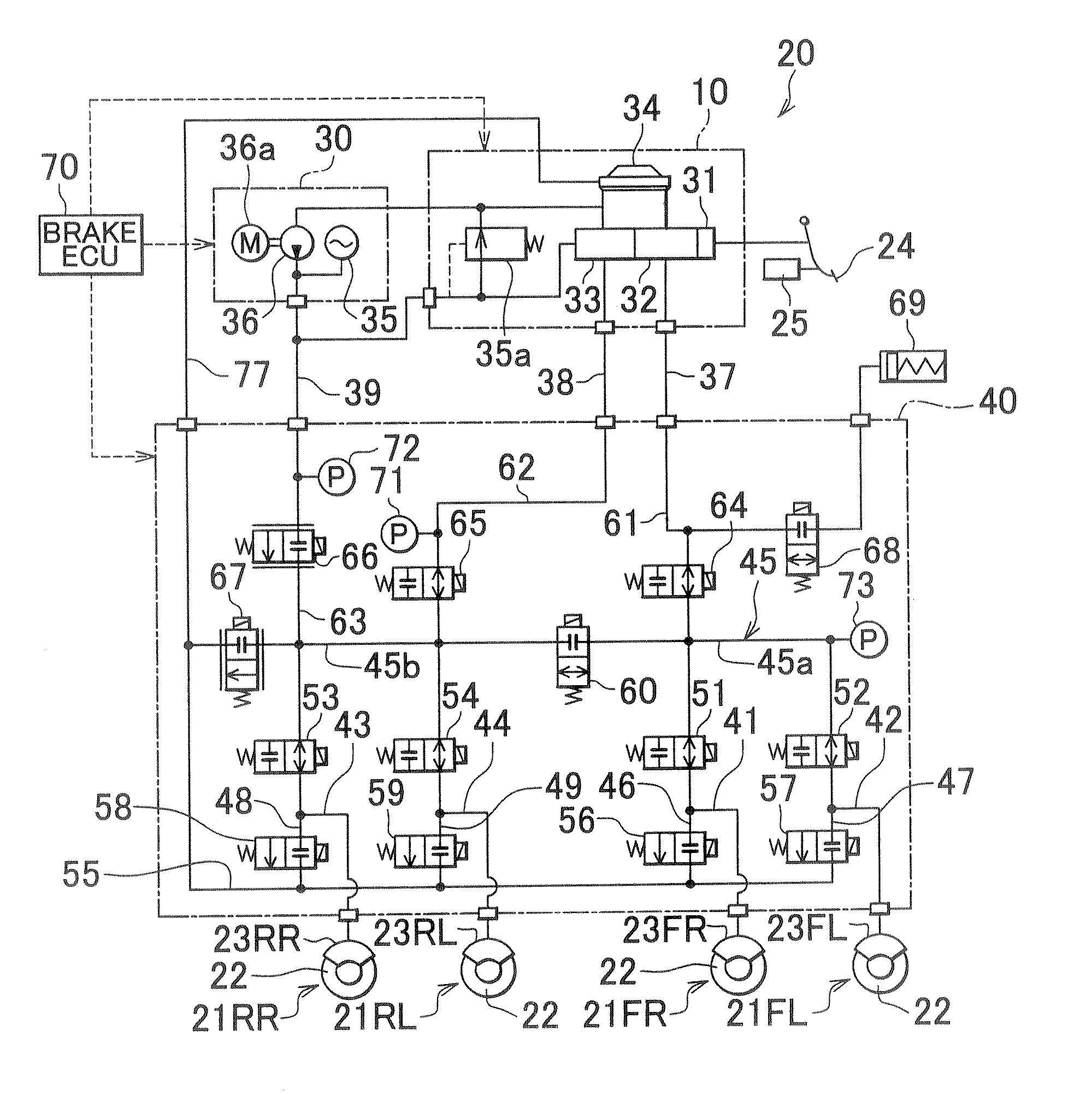

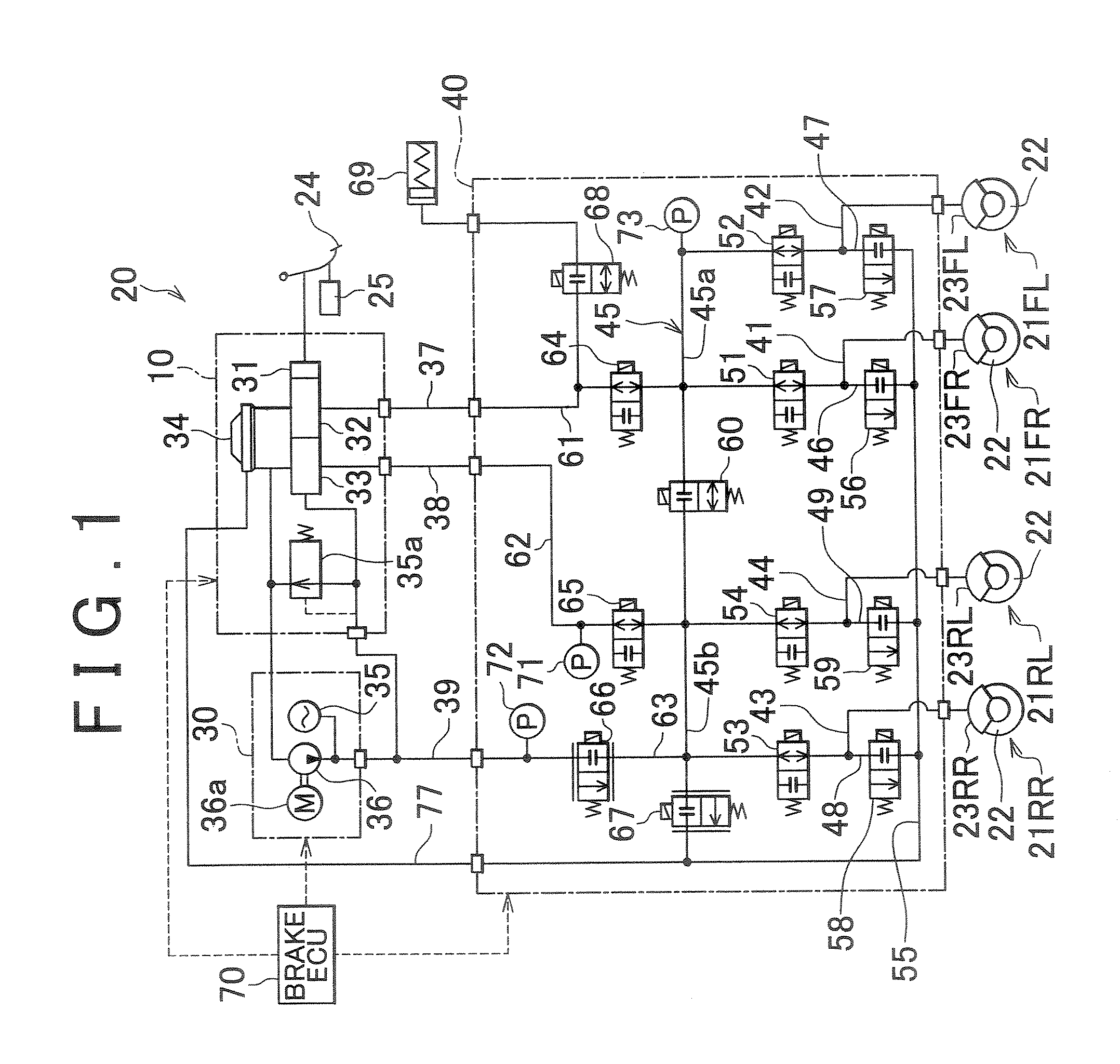

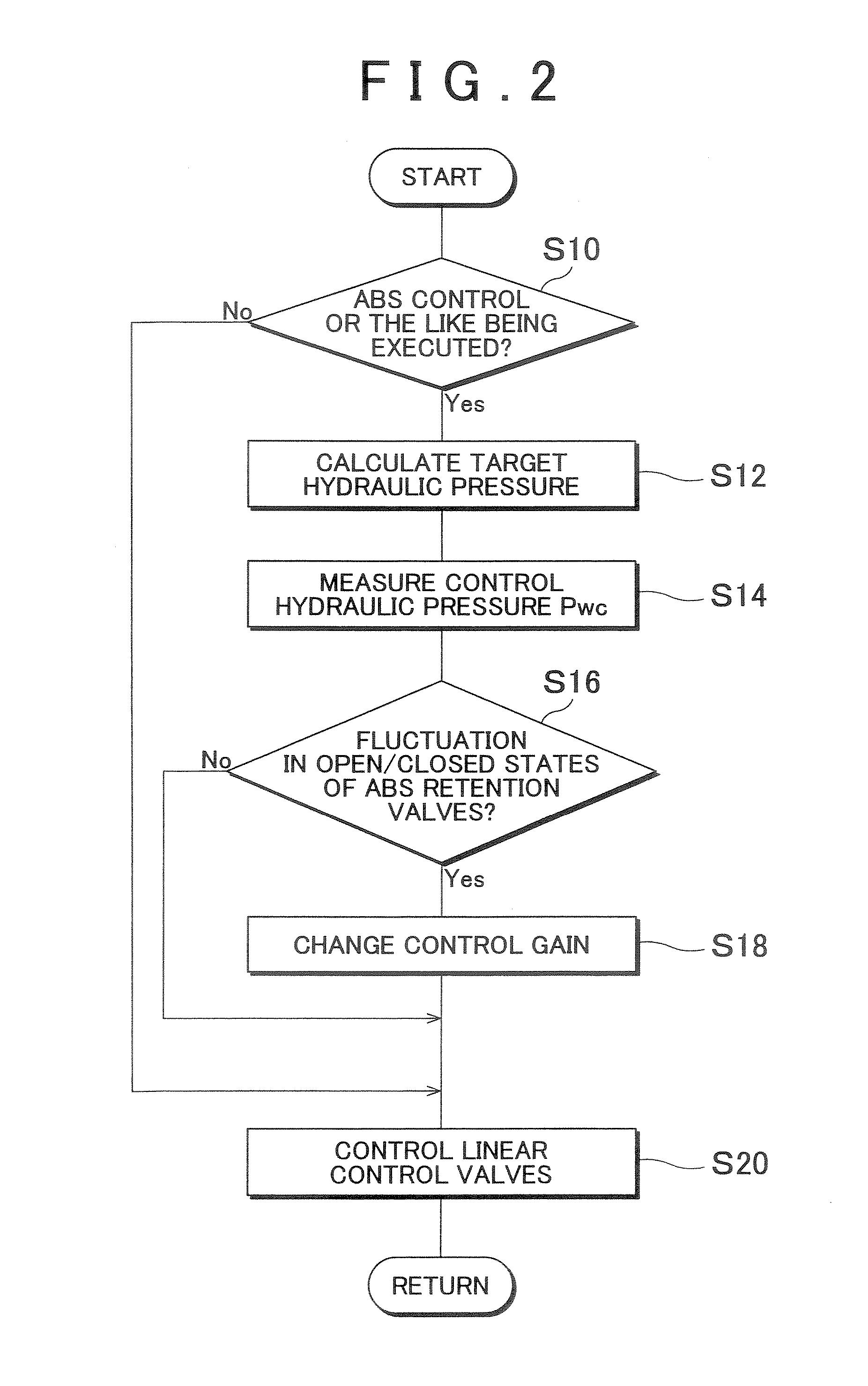

Brake control apparatus and control method thereof

ActiveUS20070114842A1Improve controllabilityMinimize fluctuationPiping arrangementsBrake cylindersWorking fluidWheel cylinder

The invention provides a brake control apparatus that improves the controllability of a vehicle in the control for restraining slip of the wheels. The brake control apparatus includes: wheel cylinders that apply braking force individually to wheels by supplying a working fluid; retention valves that are provided respectively upstream of the wheel cylinders and that are opened and closed so as to restrain slip of the wheels; a common control valve provided upstream of the retention valves to supply the working fluid to the wheel cylinders; and a control portion that controls the common control valve by different control laws to restrain fluctuations in pressure on a primary side of the retention valves caused by fluctuations in a capacity to which the working fluid from the common control valve is supplied, by opening or closing of the retention valves.

Owner:TOYOTA JIDOSHA KK

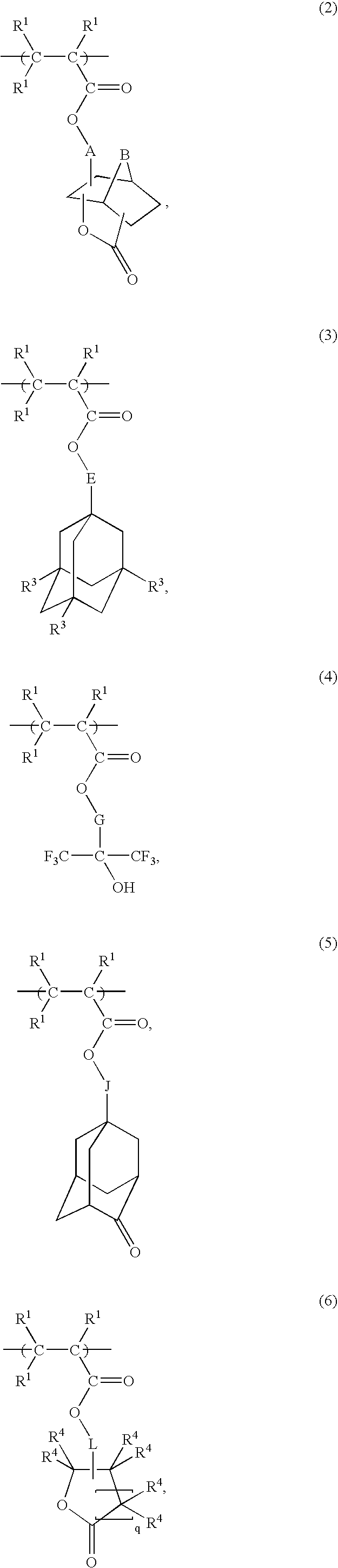

Radiation-sensitive resin composition

ActiveUS20060234154A1Molecular weight distribution can be decreasedReduce ratePhotosensitive materialsPhotosensitive materials for photomechanical apparatusPhotoacid generatorLiving free-radical polymerization

A radiation-sensitive resin composition comprising an acid-labile group-containing resin obtained by living radical polymerization having a specific structure which is insoluble or scarcely soluble in alkali, but becomes alkali soluble by the action of an acid, and a photoacid generator, wherein the ratio of weight average molecular weight to number average molecular weight (weight average molecular weight / number average molecular weight) of the acid-labile group-containing resin is smaller than 1.5.

Owner:JSR CORPORATIOON

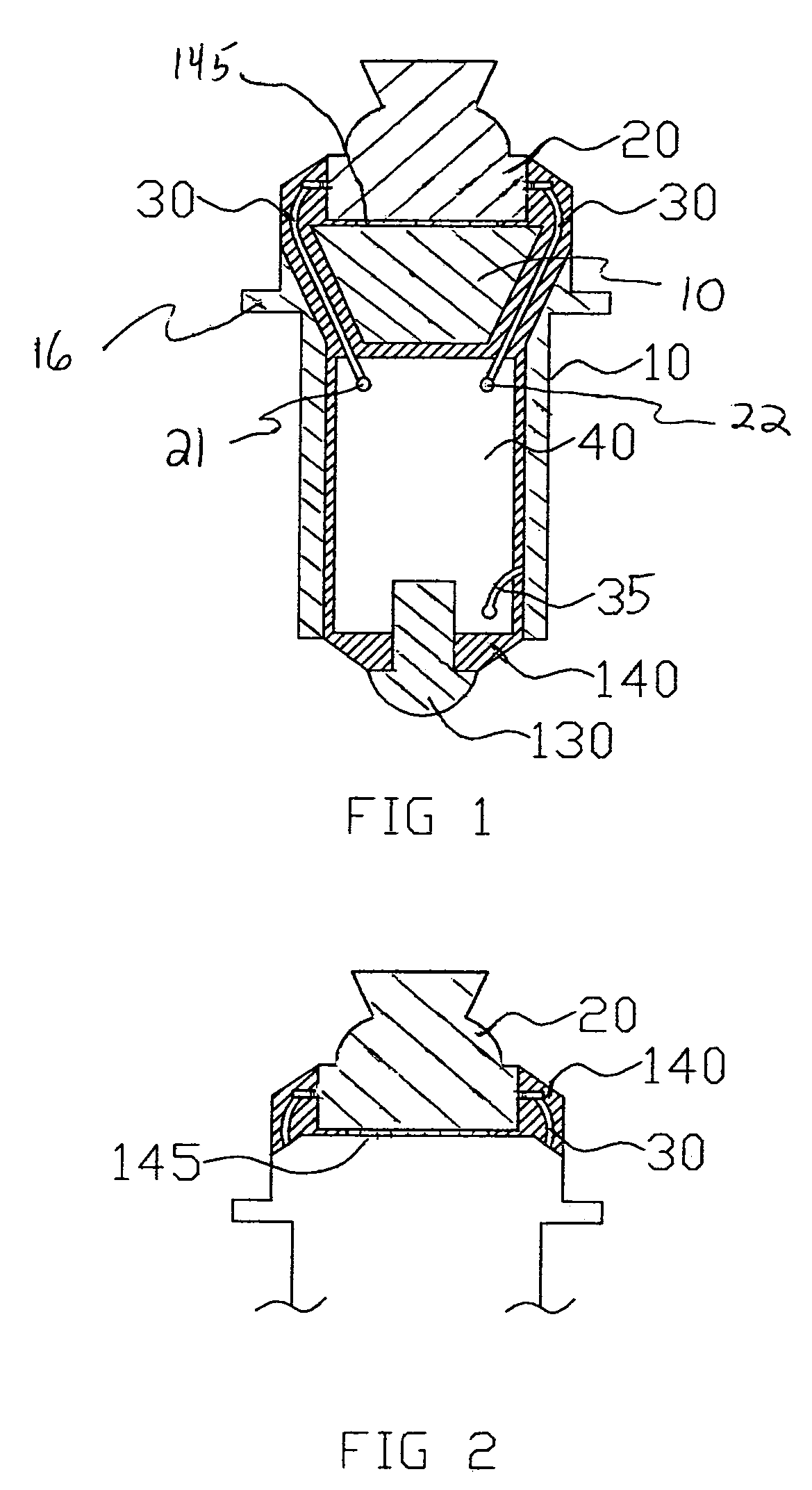

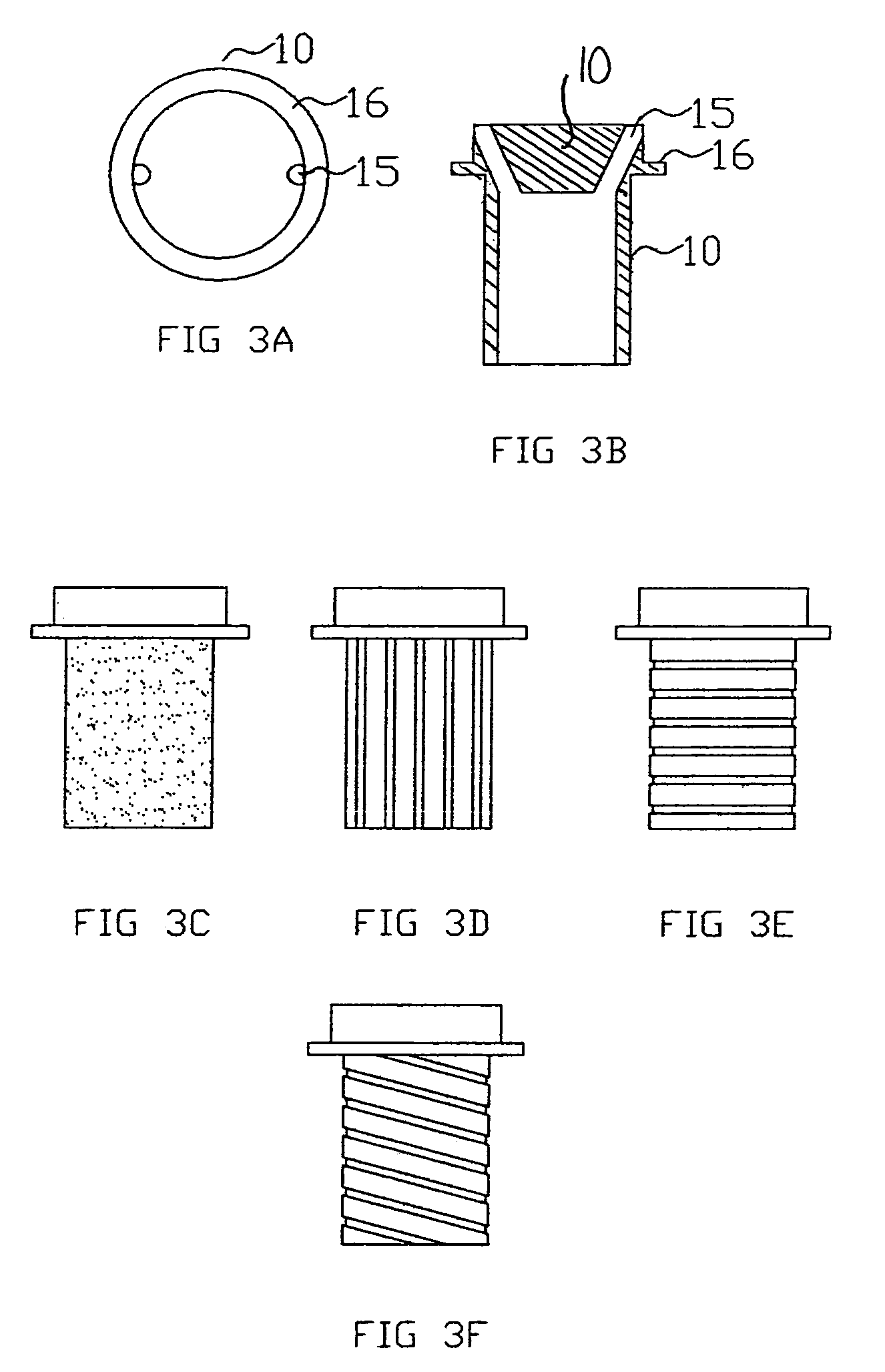

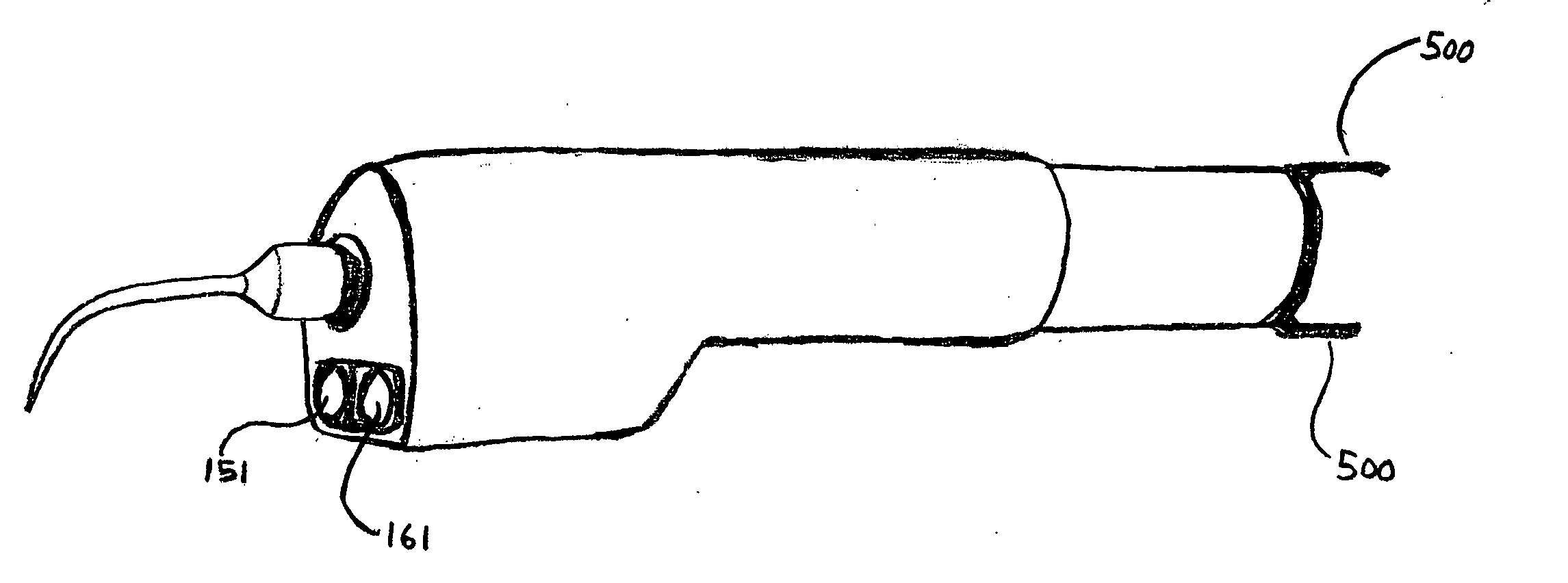

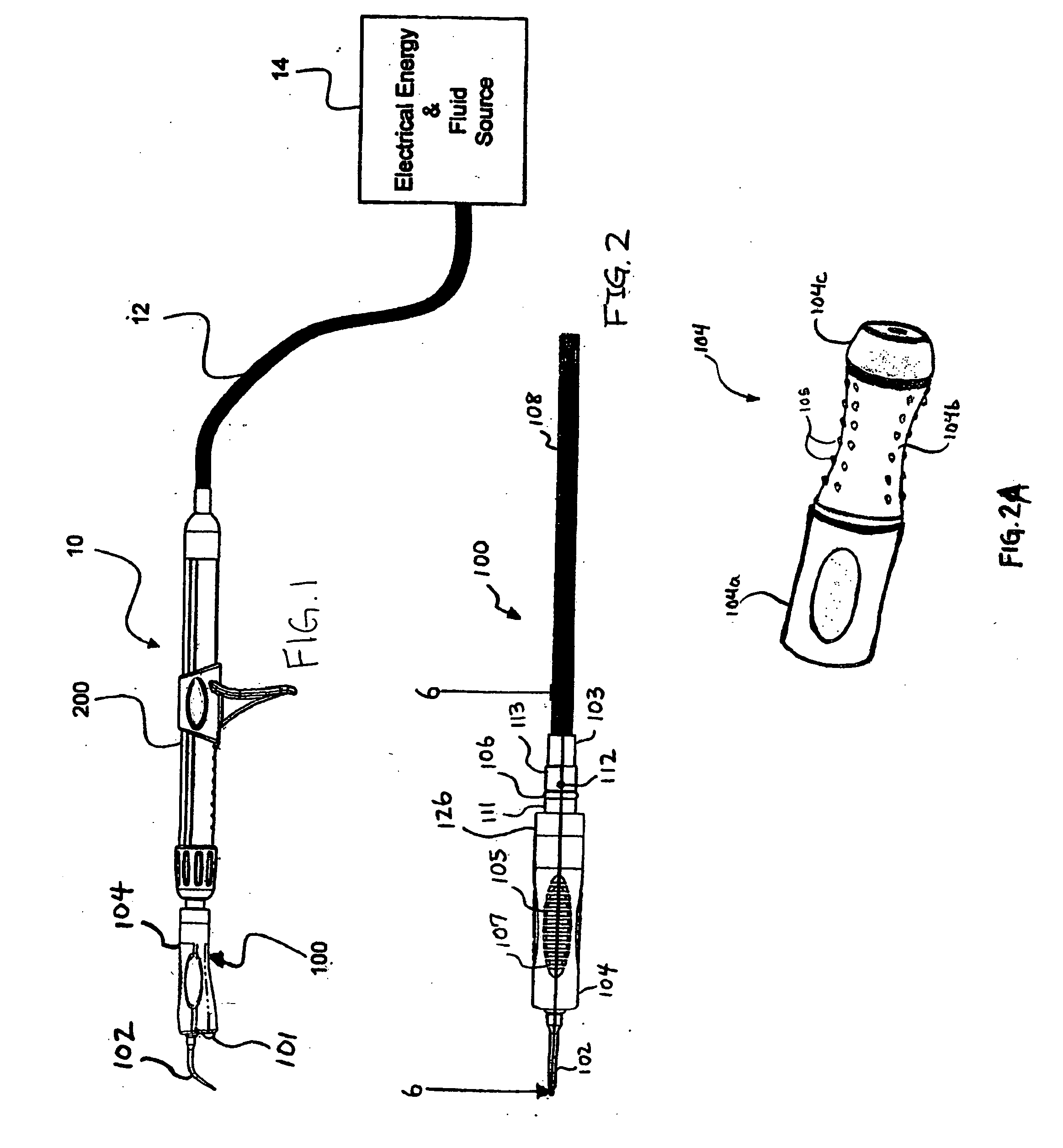

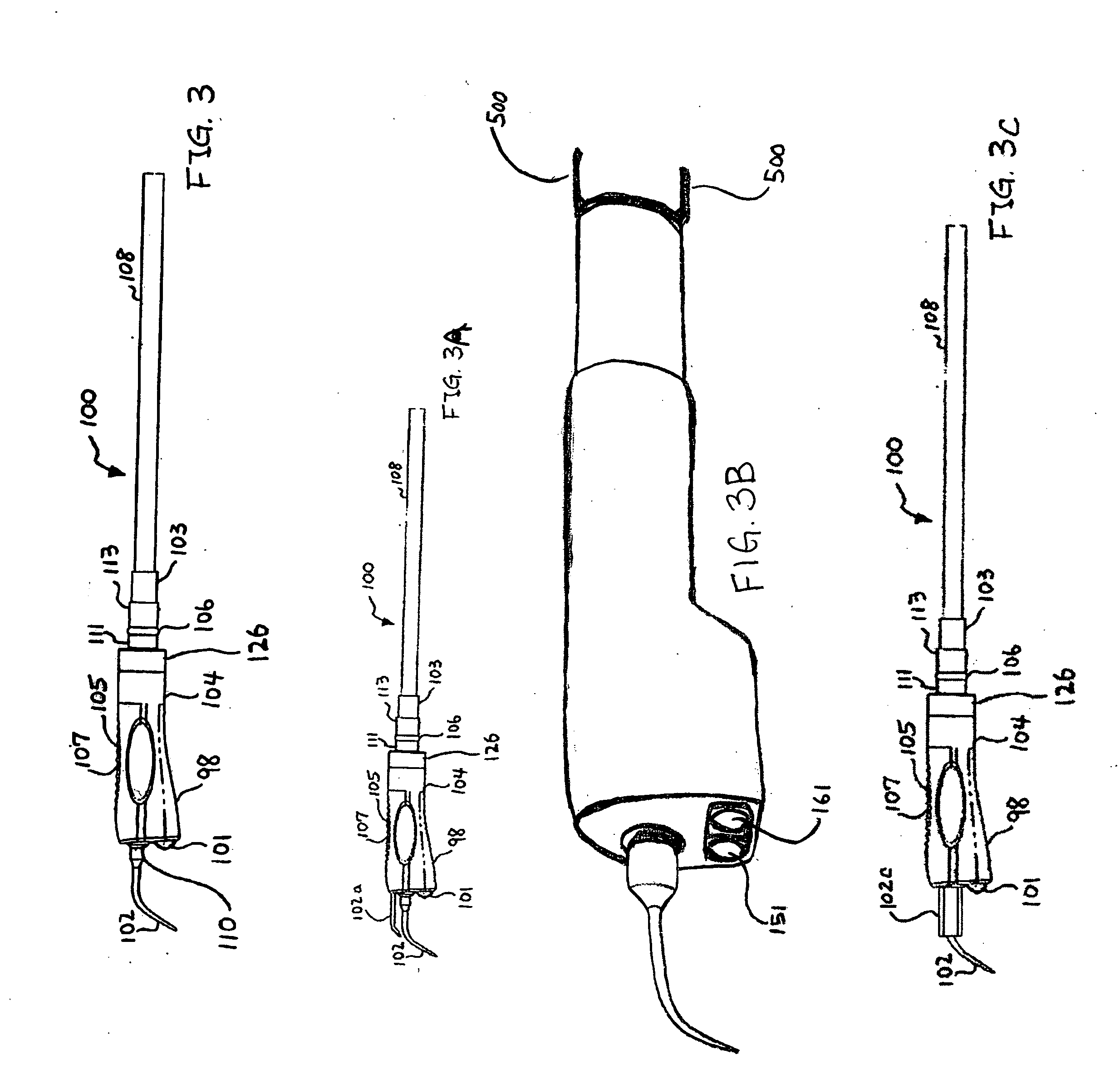

Ultrasonic dental tool having a light source

InactiveUS20060234185A1Minimize input voltage fluctuationMinimize fluctuationTooth pluggers/hammersBoring toolsDental insertEngineering

An ultrasonic dental insert having at least one light source. A first transducer generates ultrasonic vibrations. A connecting body has a proximal end and a distal end having a tip attached thereto. The proximal end is attached to the first transducer so as to receive the ultrasonic vibrations therefrom and to transmit the ultrasonic vibrations toward the tip attached to the distal end. A second transducer is disposed substantially proximate to the connecting body for generating a voltage signal in response to movement of a portion of the connecting body according to the ultrasonic vibrations. A magnetic material including a source of a magnetic field is present in close proximity to the insert. At least one light source substantially proximate to the tip is connected to and receives the voltage signal from the second transducer to generate light. The ultrasonic dental insert may be inserted into a handpiece for providing electromagnetic energy to the first transducer to generate the ultrasonic vibrations.

Owner:DISCUS DENTAL LLC +1

Chemically amplified resist composition, process for manufacturing semiconductor device and patterning process

ActiveUS7479361B2Minimize fluctuationInhibited DiffusionPhotosensitive materialsSemiconductor/solid-state device manufacturingResistPhotoacid generator

Owner:RENESAS ELECTRONICS CORP

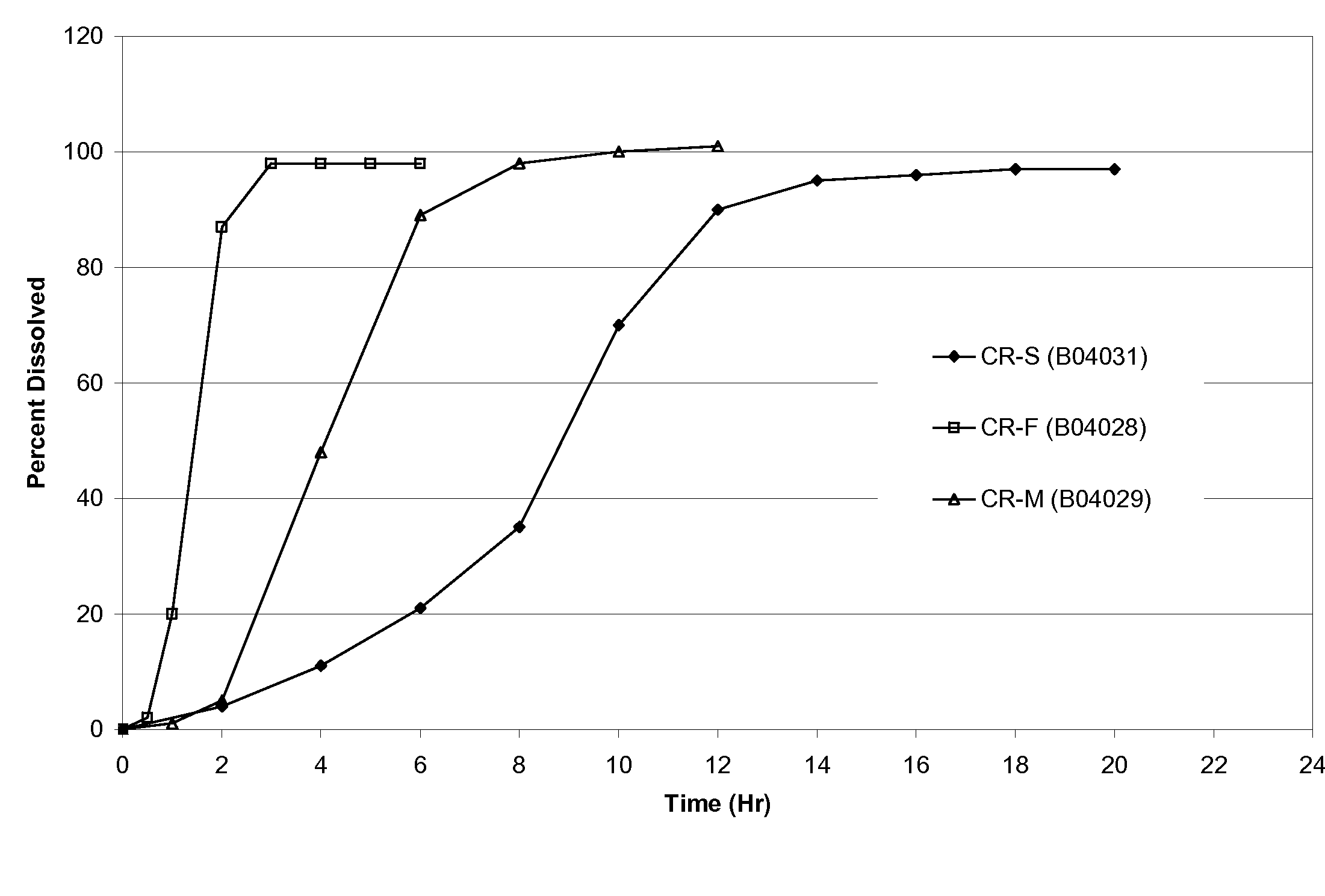

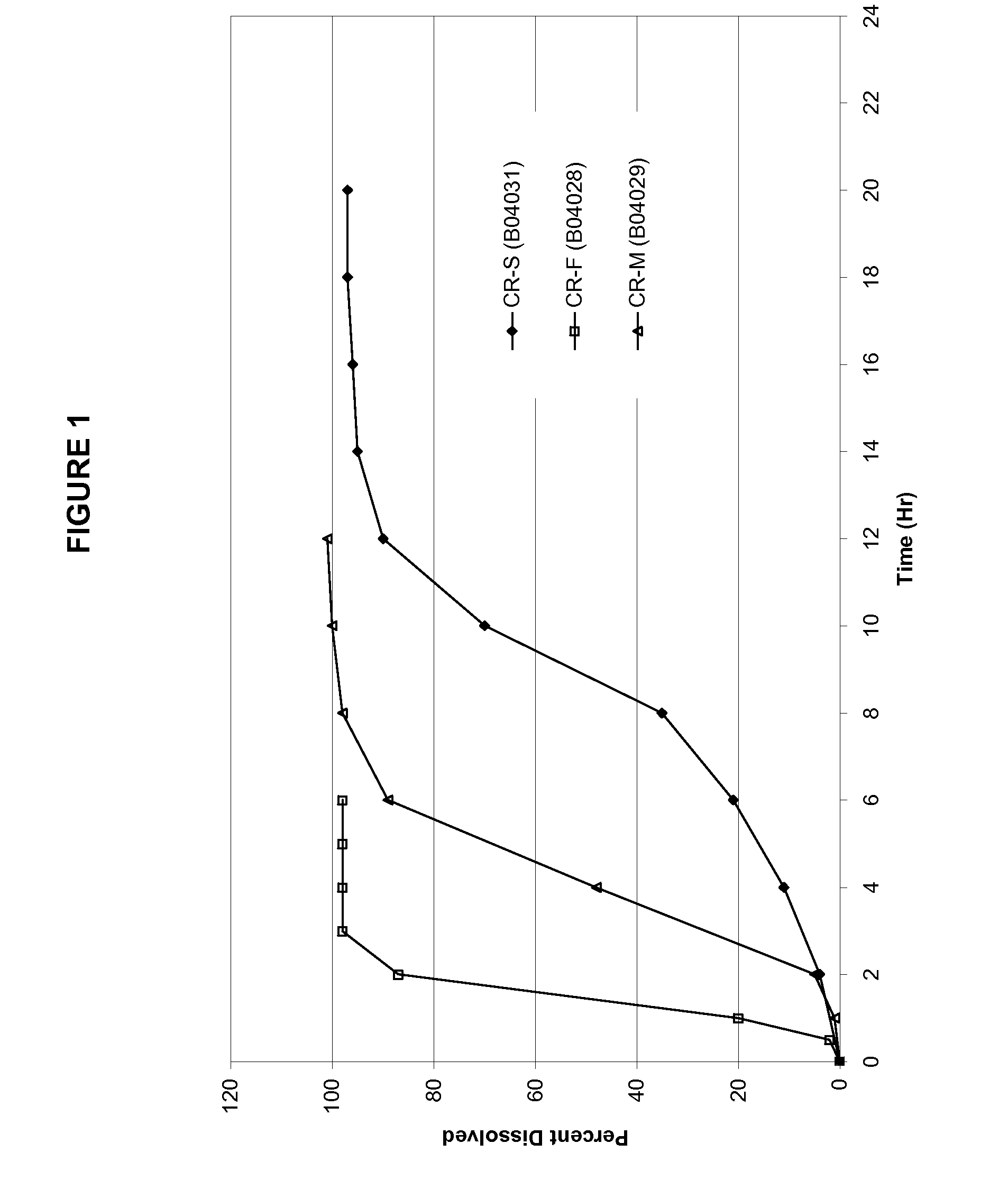

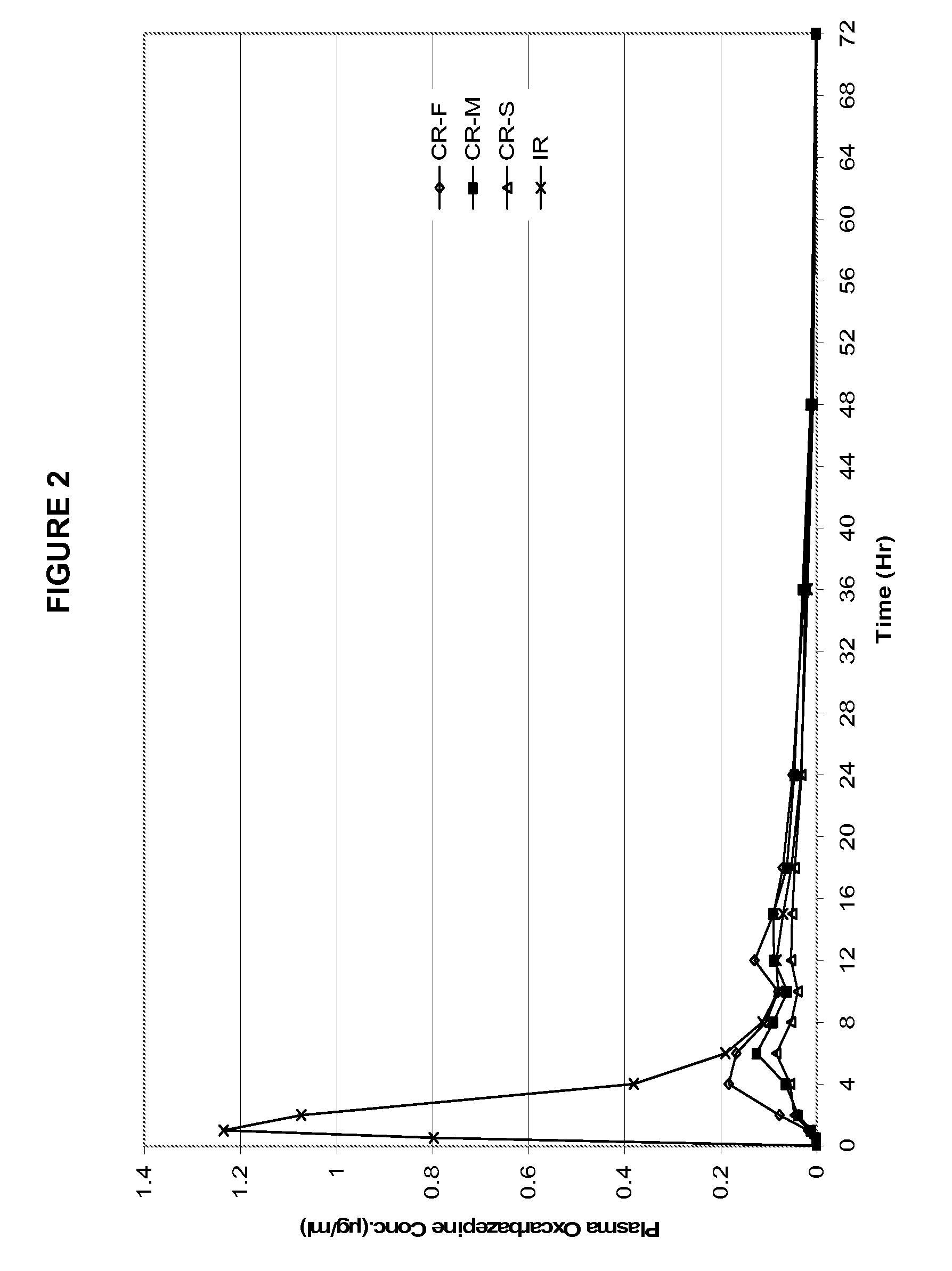

Modified-release preparations containing oxcarbazepine and derivatives thereof

ActiveUS20070254033A1Reduce volatilityBetter therapeutic profilePowder deliveryNervous disorderSolubilityOxcarbazepine

Controlled-release preparations of oxcarbazepine and derivatives thereof for once-a-day administration are disclosed. The inventive compositions comprise solubility-and / or release enhancing agents to provide tailored drug release profiles, preferably sigmoidal release profiles. Methods of treatment comprising the inventive compositions are also disclosed.

Owner:SUPERNUS PHARM INC

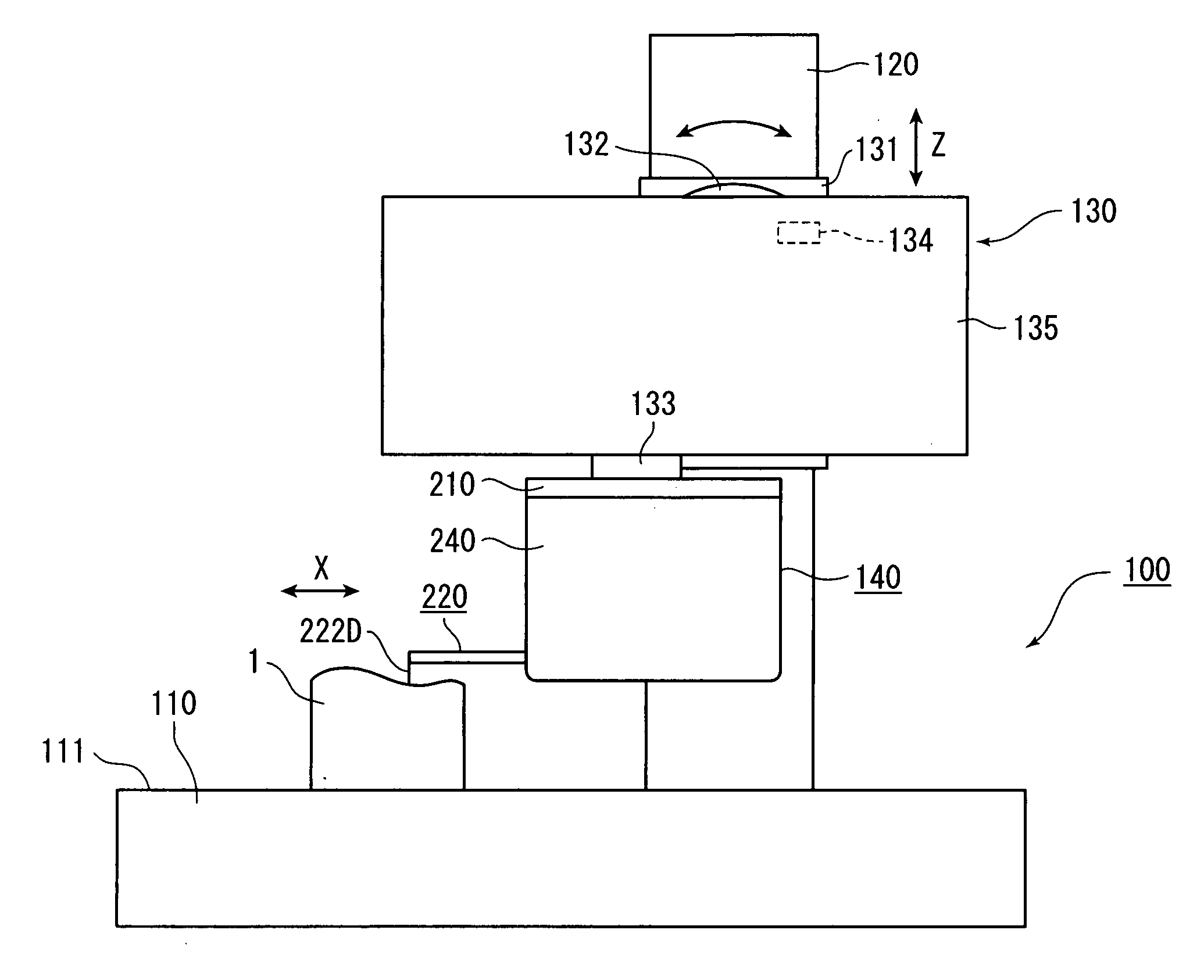

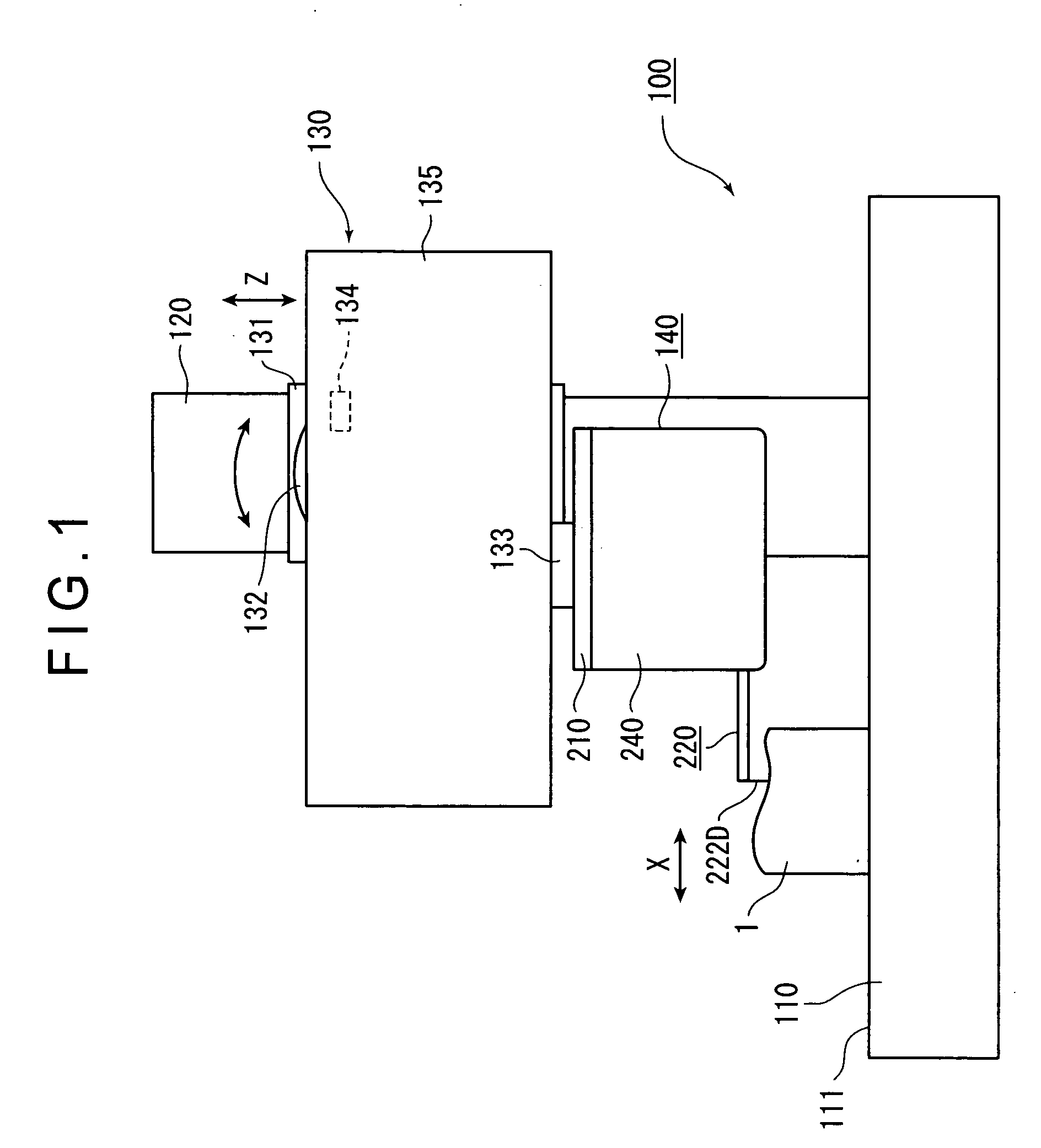

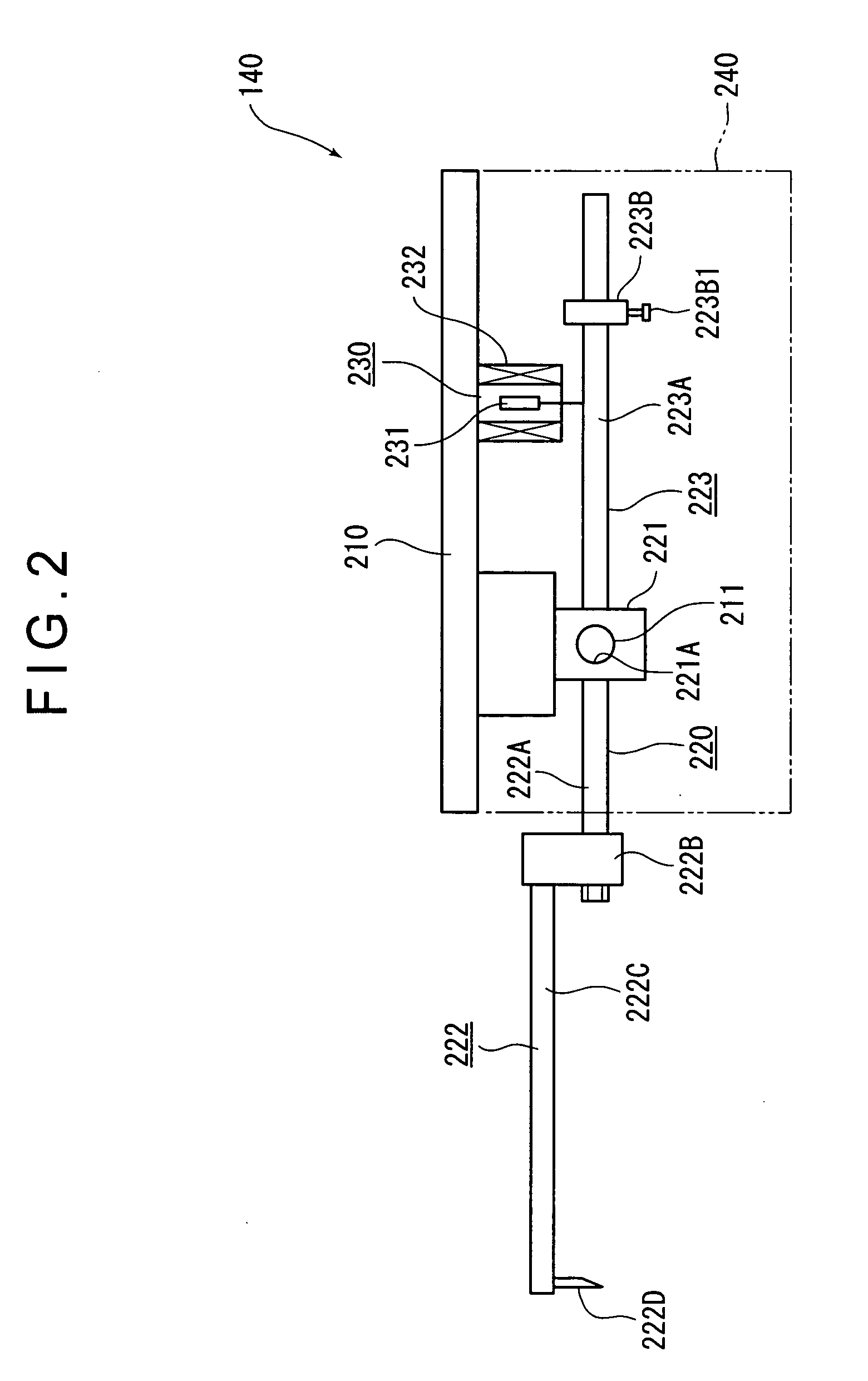

Measuring instrument

ActiveUS20040168332A1Avoid poor resultsAvoid measuringMechanical counters/curvatures measurementsMechanical roughness/irregularity measurementsMeasuring instrumentEngineering

Centroid moments of components of an arm (220) are calculated based on three-dimensional model data and mass of the components, the centroid moments being combined to calculate a centroid position (G) of the entirety of the arm (220). The arm (220) is adjusted and swingably supported so that a stylus (222D) provided on an end of the arm (220) being swingably supported by a support (210) that moves relative to a workpiece (1) touches the workpiece (1) with a predetermined measuring force and the centroid position (G) is located on a horizontal plane including the fulcrum when the support (210) is inclined by an angle in the middle of an angle range within which the support (210) is rotated by a moving section (130). The measuring force is hardly fluctuated when the support (210) is inclined.

Owner:MITUTOYO CORP

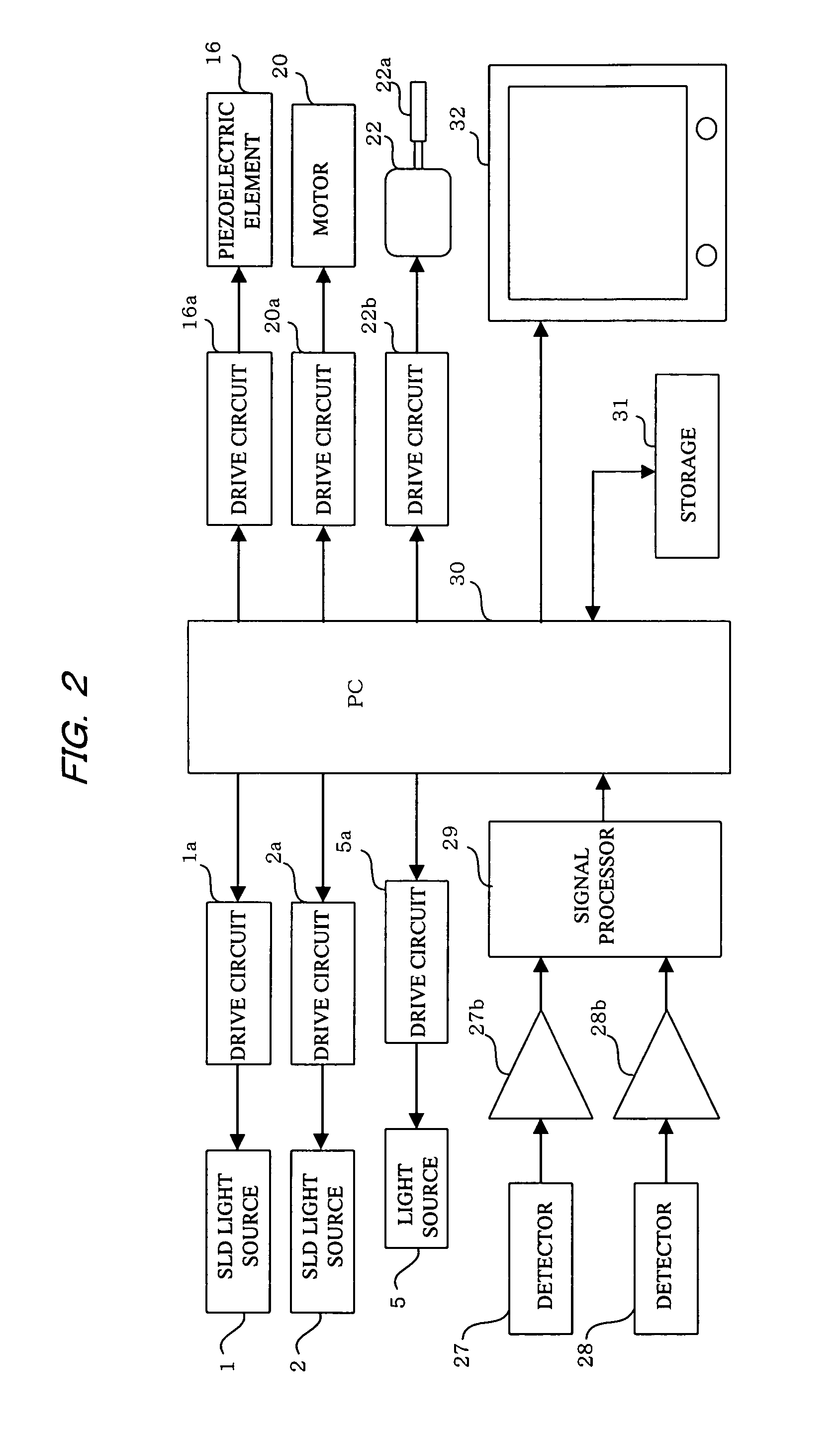

Optical tomograph

InactiveUS20080100848A1High resolutionIncrease contrastInterferometersMaterial analysis by optical meansOptical axisLight beam

A partially coherent light beam from a light source is split between a probe light beam toward an observation object and a reference light beam toward a fixed reflective surface. The frequency of the probe light beam is shifted by optical-modulation means. The probe light beam whose frequency has been shifted is swept in a direction of an optical axis and in a direction orthogonal thereto to scan the object two-dimensionally. Reflected light beam from the object is combined with the reference light beam to generate interference light. A detector receives a time-based interference signal from the interference light obtained from the movement of the probe light beam in the direction of the optical axis and the sweeping in the direction orthogonal to the optical axis to derive therefrom reflection intensity data of the object. In such a configuration, the mechanically moving portion is disposed in the probe optical path. Therefore, changes in the interference characteristics of the light that accompany the mechanical scanning are less likely to occur and optical adjustments are also made easy.

Owner:KOWA CO LTD

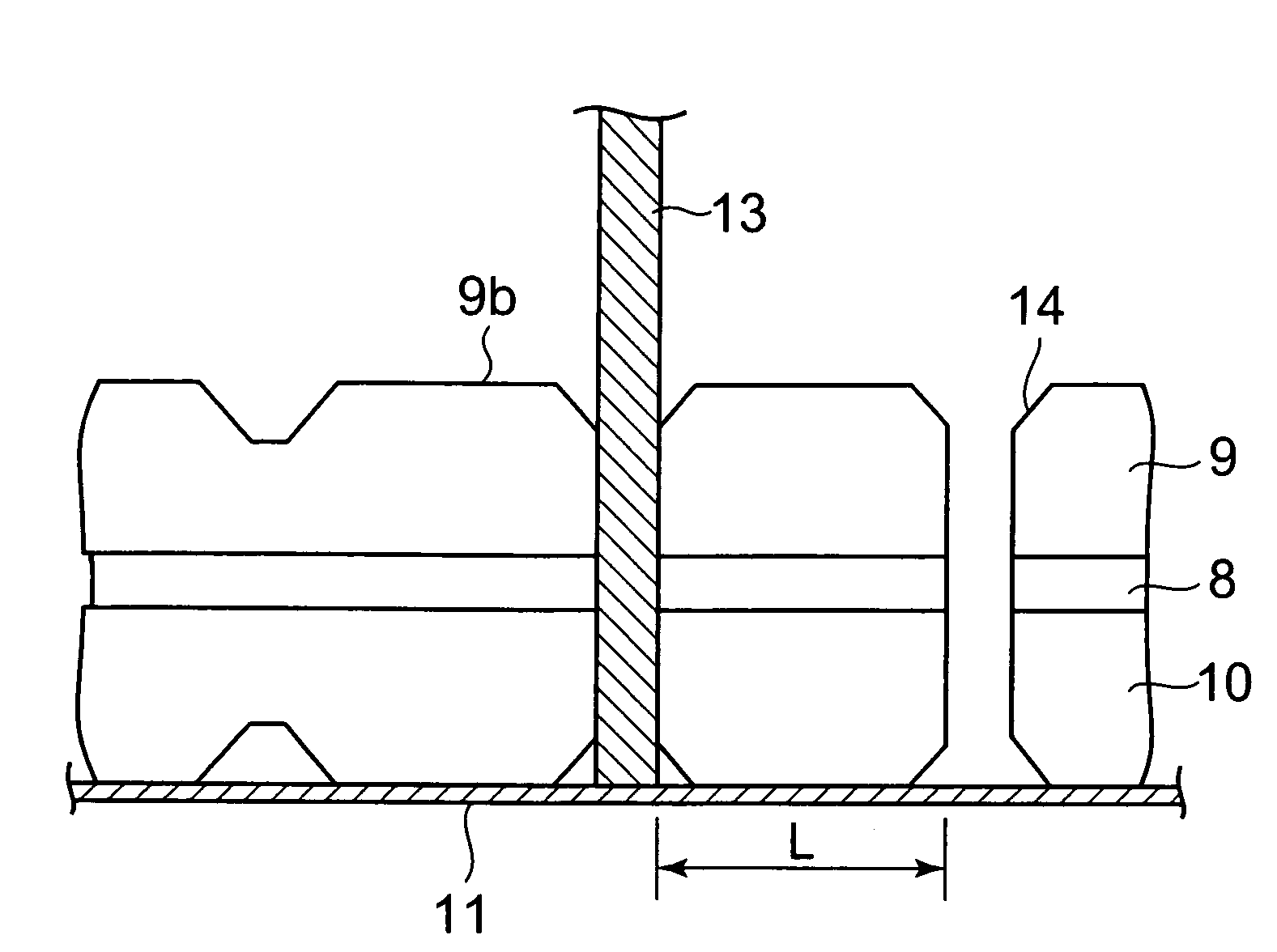

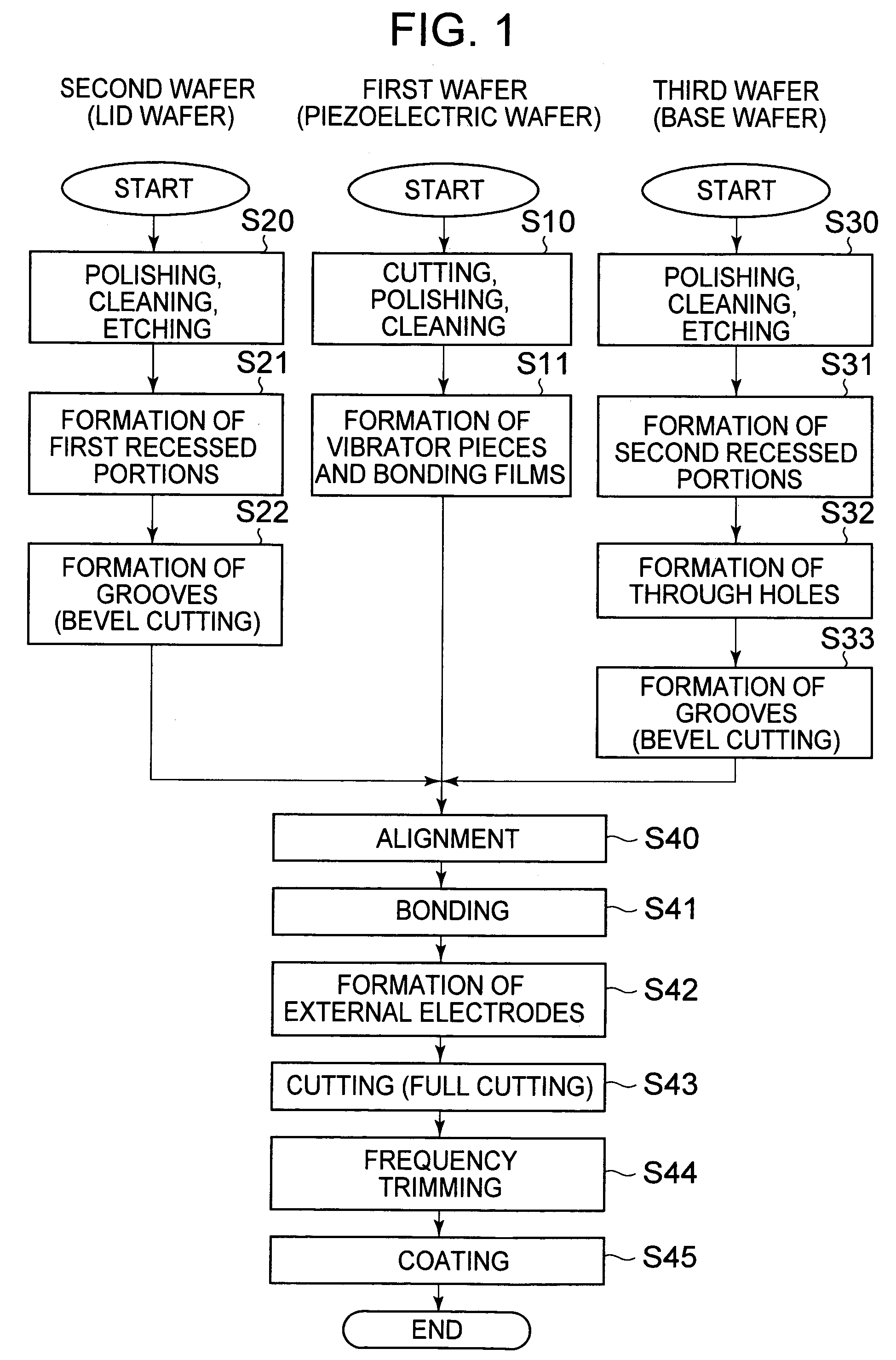

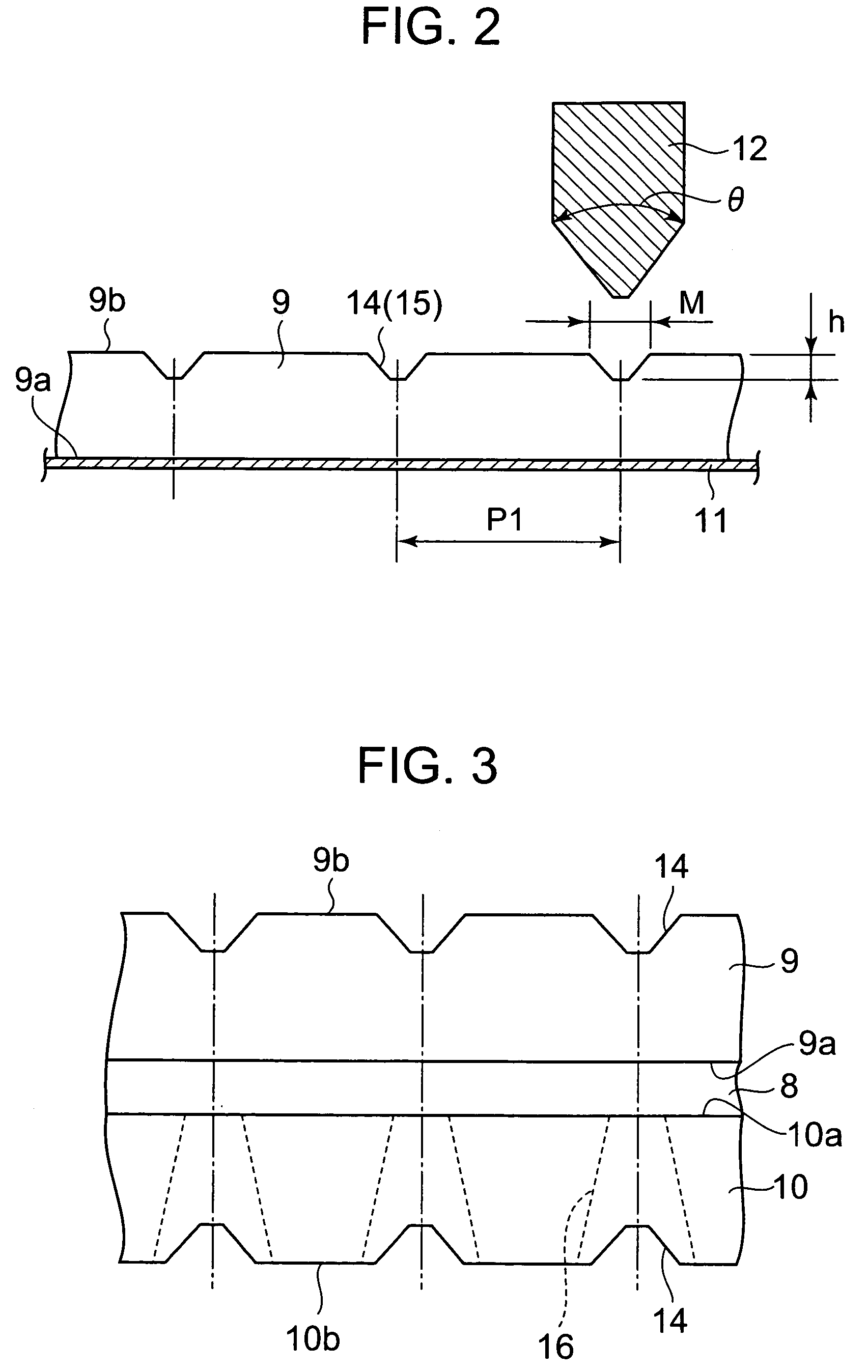

Piezoelectric vibrator, manufacturing method thereof, oscillator, electronic equipment, radio clock

InactiveUS7294951B2Minimize fluctuationReduce manufacturing costPiezoelectric/electrostrictive device manufacture/assemblyPiezoelectric/electrostriction/magnetostriction machinesRadio clockAnodic bonding

Owner:SII CRYSTAL TECH

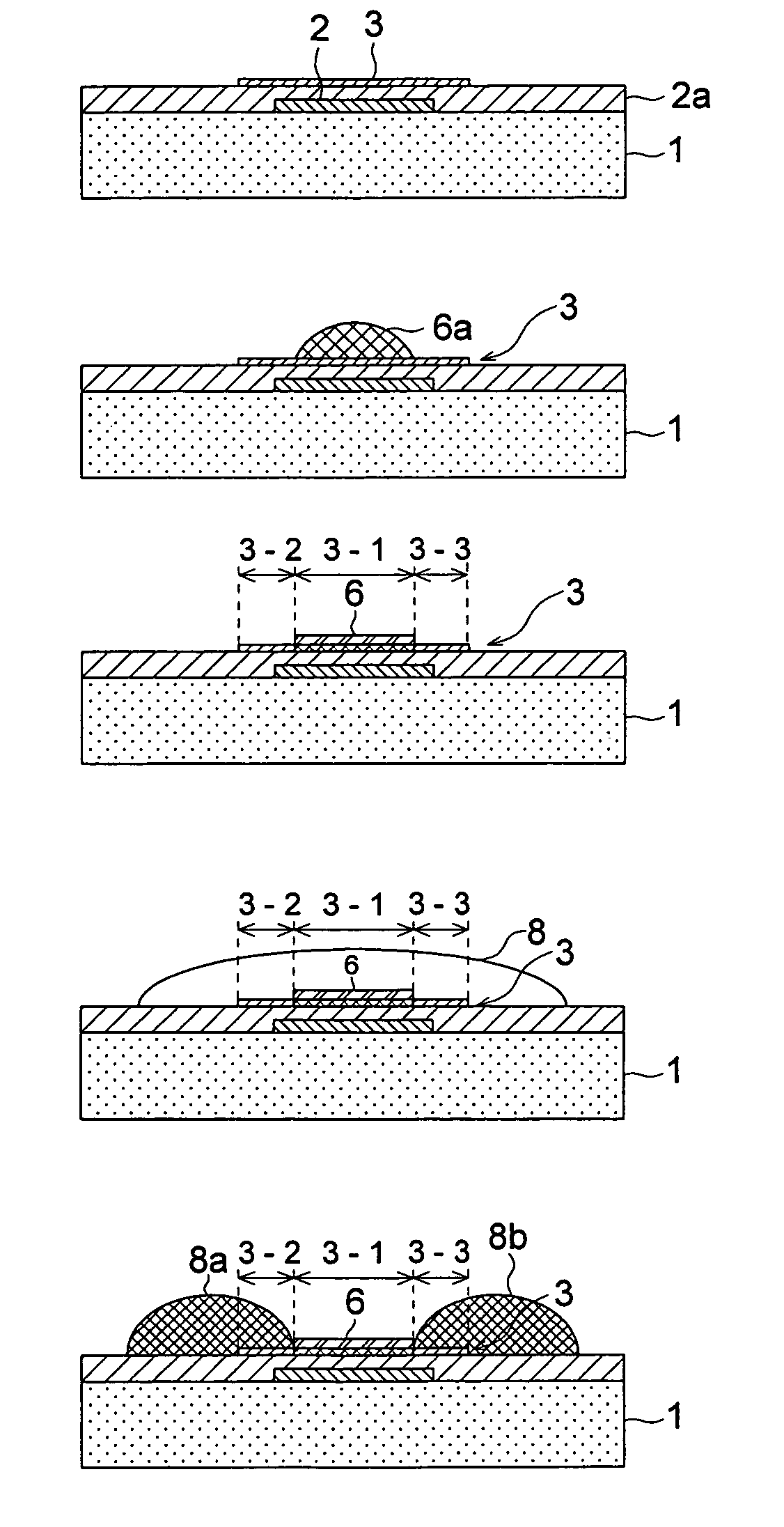

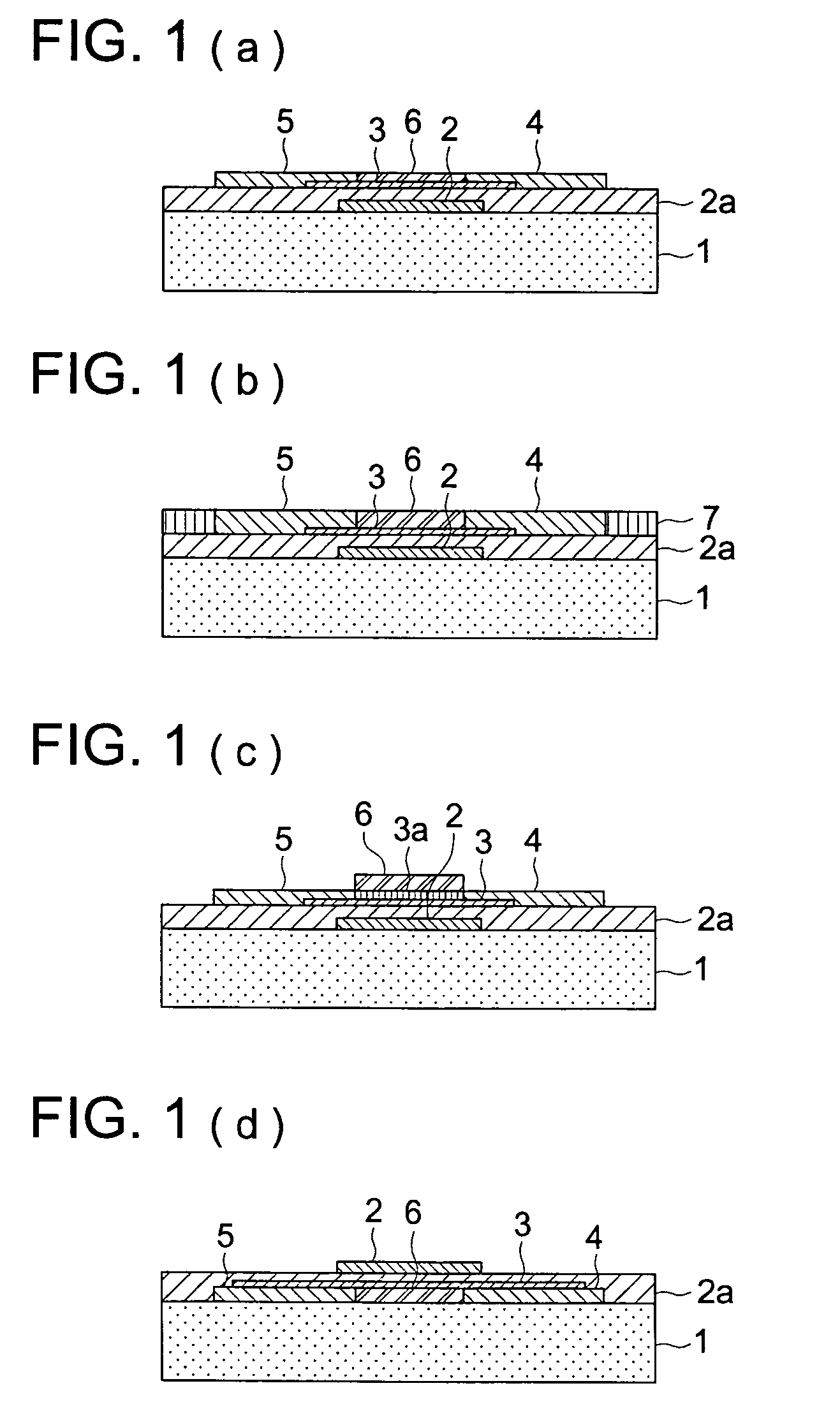

Manufacturing method of thin-film transistor, thin-film transistor sheet, and electric circuit

InactiveUS7368331B2Minimize fluctuationEasy and efficient to manufactureTransistorSolid-state devicesSemiconductor materialsTransistor

A thin-film transistor, a thin-film transistor sheet, an electric circuit, and a manufacturing method thereof are disclosed, the method comprising the steps of forming a semiconductor layer by providing a semiconductive material on a substrate, b) forming an isolating area, which is electrode material-repellent, by providing an electrode material-repellent material on the substrate, and c) forming a source electrode on one end of the insulating area and a drain electrode on the other end of the insulating area, by providing an electrode material.

Owner:FLEX DISPLAY SOLUTIONS LLC

Susceptor, semiconductor manufacturing apparatus, and semiconductor manufacturing method

ActiveUS20090272323A1Minimize fluctuationImprove productivitySemiconductor/solid-state device manufacturingFrom chemically reactive gasesSusceptorSemiconductor

A susceptor includes a first step portion on which a wafer is placed; and a convex portion placed on a bottom surface of the first step portion, wherein a void is formed between a top surface of the convex portion and a rear surface of the wafer in a state in which the wafer is placed on the top surface of the convex portion.

Owner:NUFLARE TECH INC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com