Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

212results about How to "Save steps" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Systems for Atomic Layer Deposition of Oxides Using Krypton as an Ion Generating Feeding Gas

InactiveUS20070277735A1Great efficiencyGreat capabilitySolid-state devicesSemiconductor/solid-state device manufacturingIonOxide

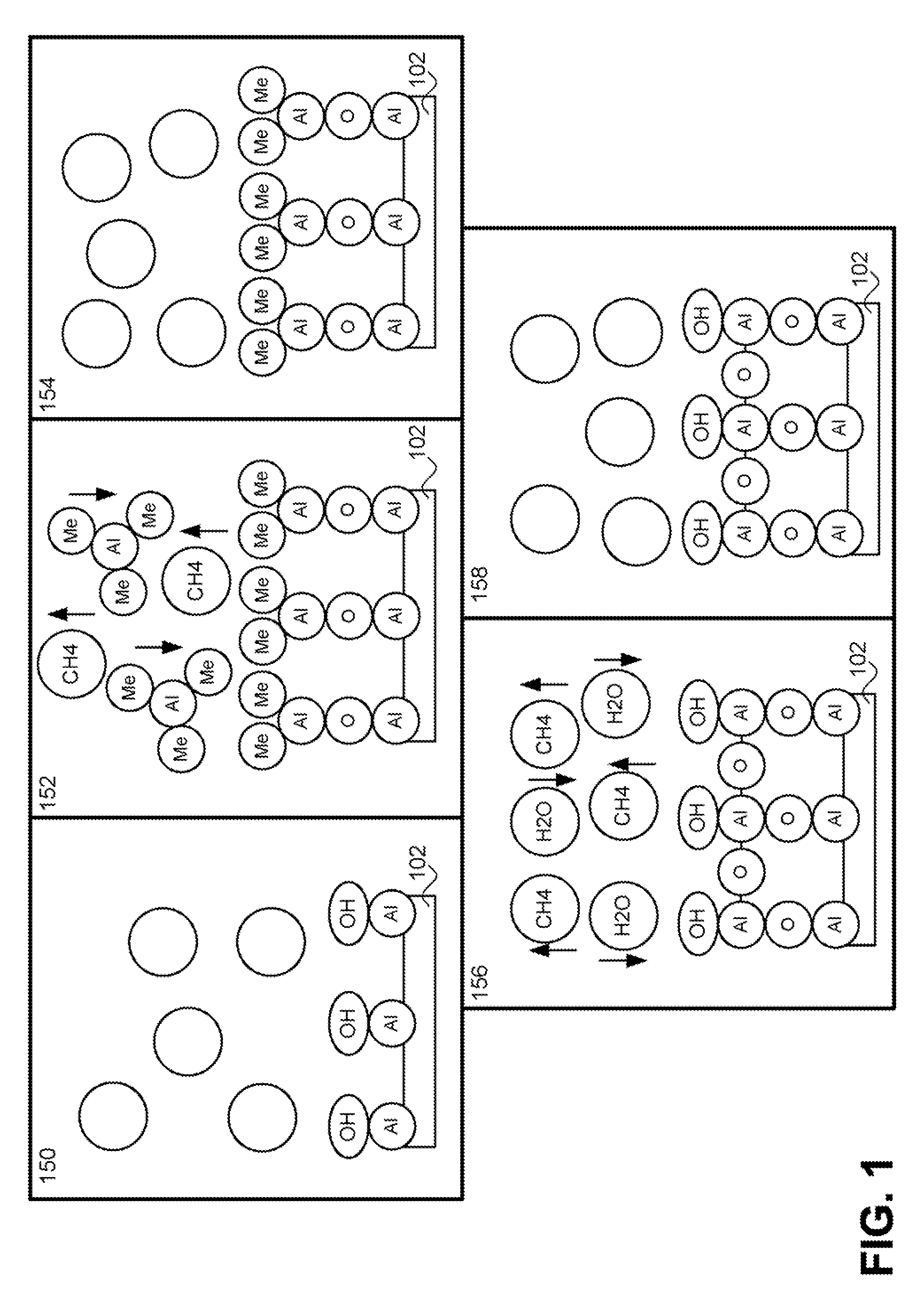

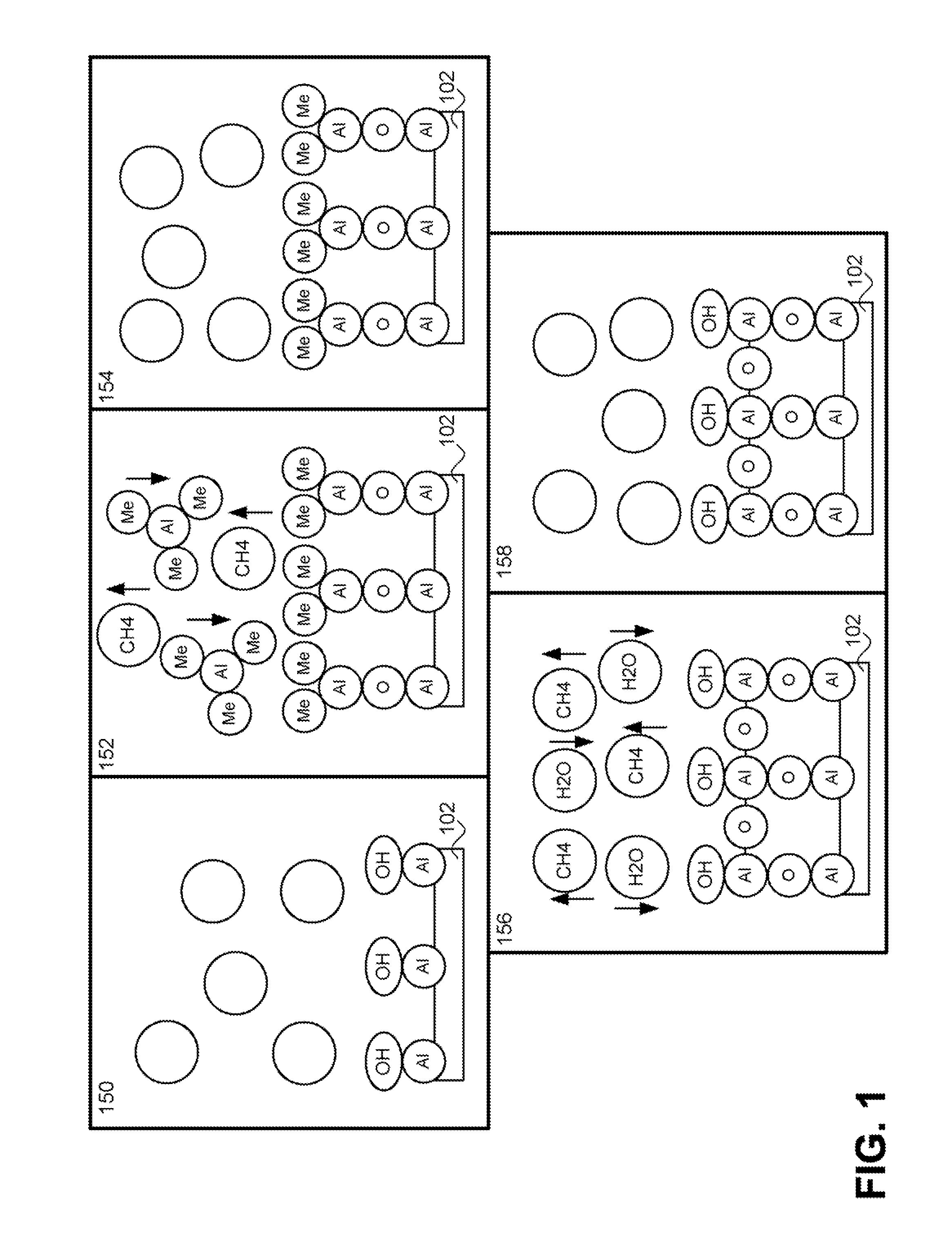

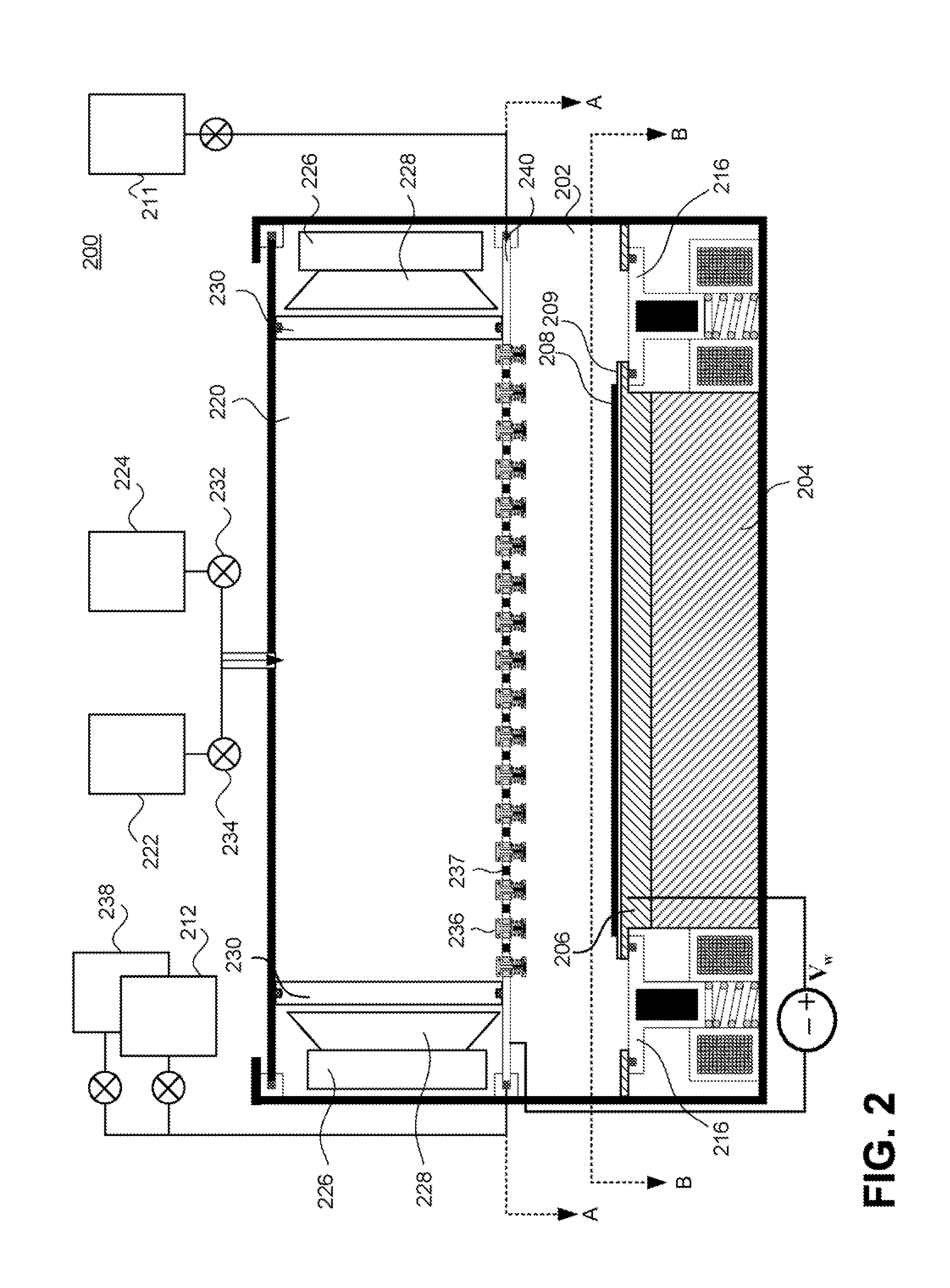

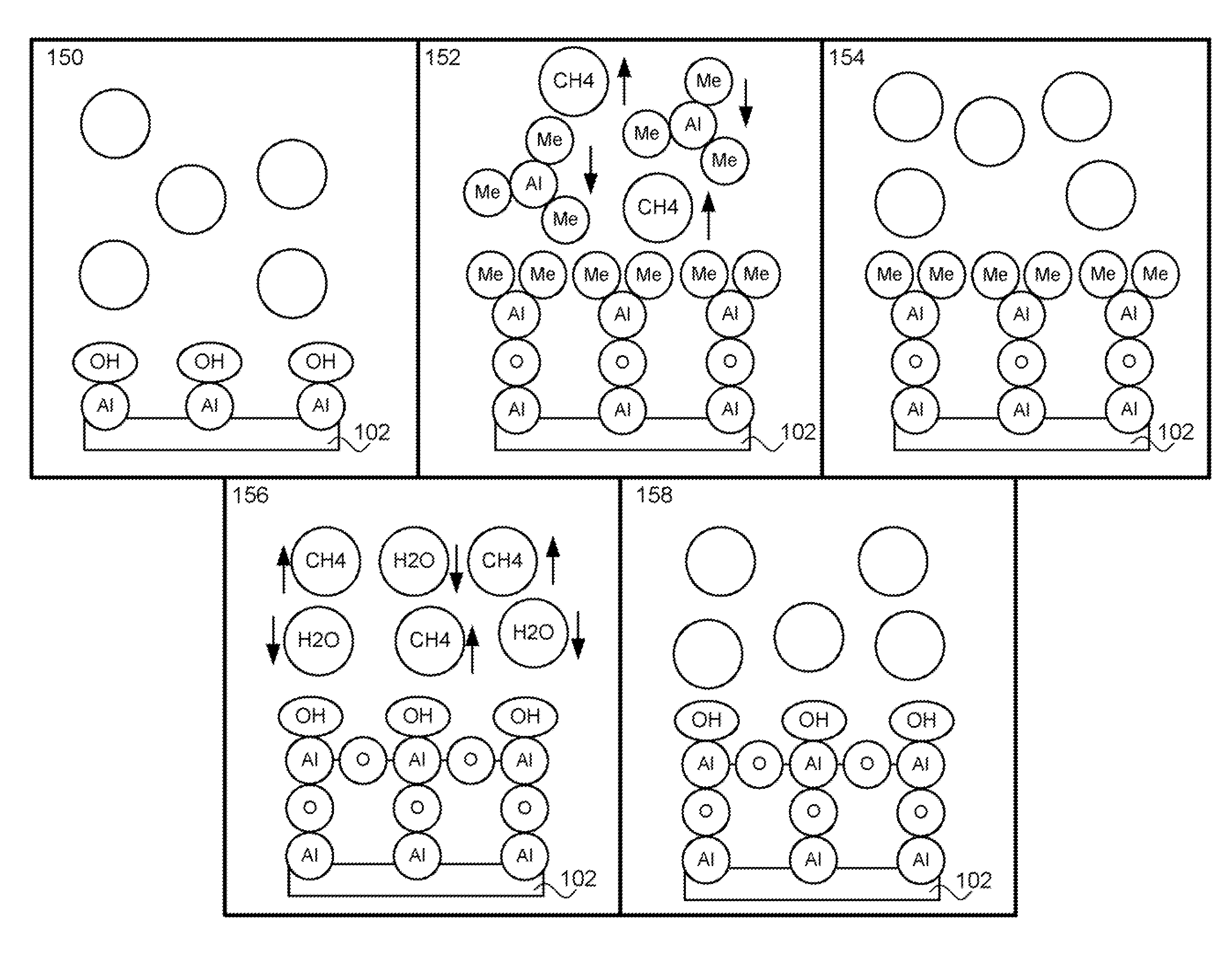

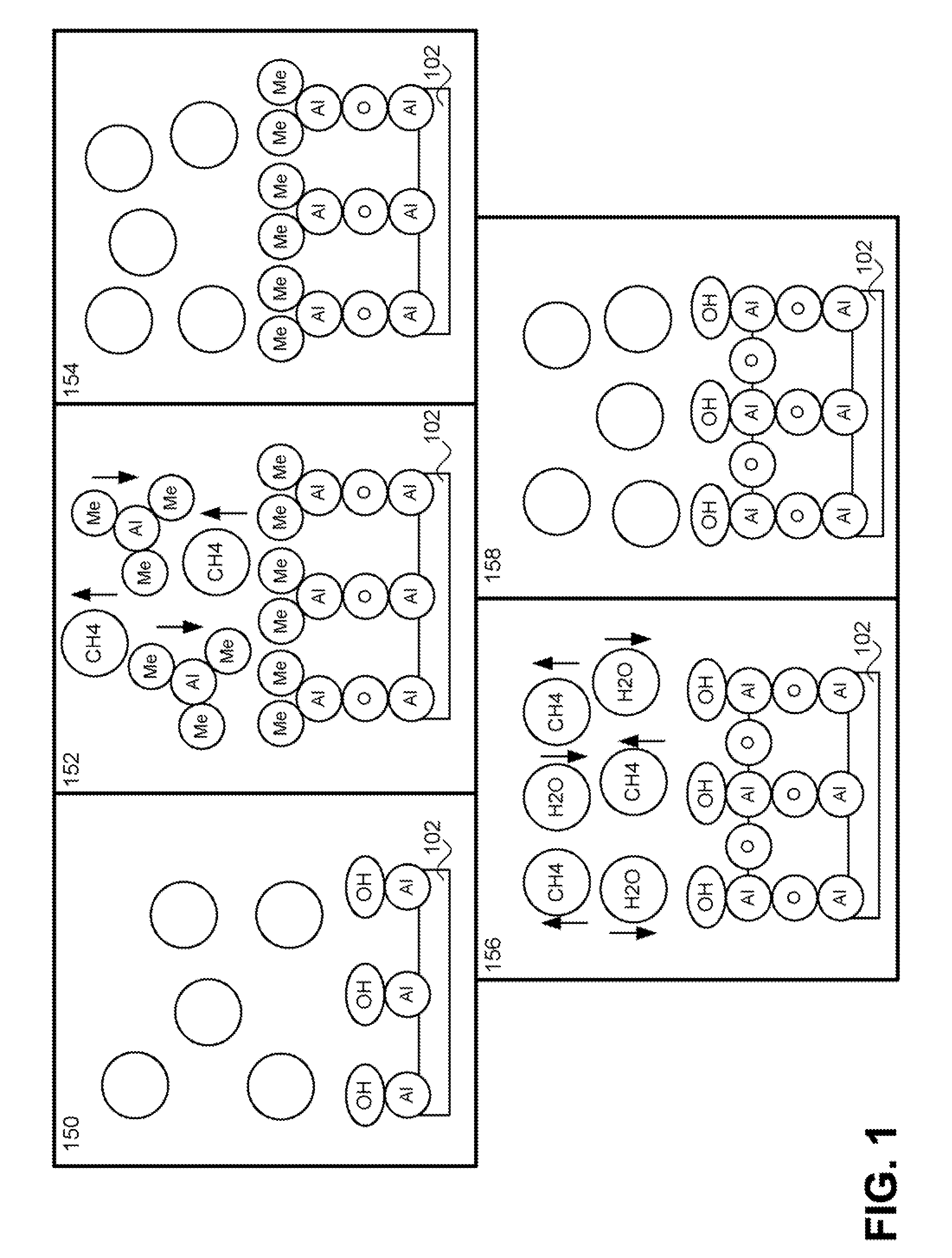

An atomic layer deposition system and method utilizing radicals generated from a high-density mixed plasma for deposition is disclosed. A high-quality oxide or oxynitride can be deposited by exposing a substrate to a first precursor which is adsorbed onto the substrate during a first phase of one deposition cycle. After purging the deposition chamber, the substrate is exposed to a second precursor which includes oxygen radicals and krypton ions formed from the high-density mixed plasma. The ions and radicals are formed by introducing a radical generating feed gas (e.g., O2) and an ion generating feed gas into a plasma chamber and exciting the gases to form the high-density mixed plasma. The radicals and ions are then introduced to the substrate where they react with the first precursor to deposit a layer of the desired film. Krypton is preferably used as the ion generating feed gas because the metastable states of krypton lead to an efficient dissociation of oxygen into oxygen radicals when compared with other inert gases.

Owner:SANDISK TECH LLC

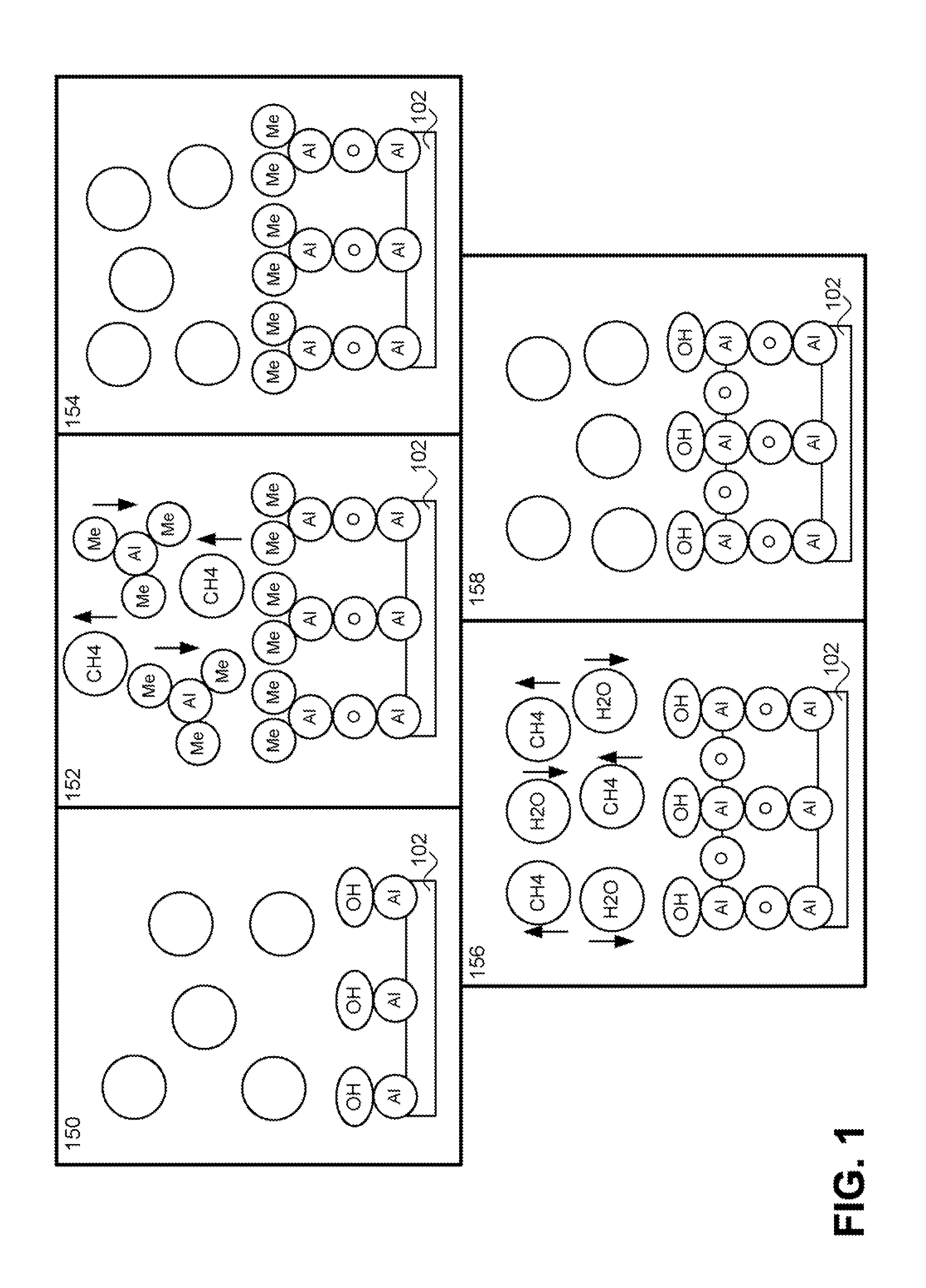

Atomic Layer Deposition of Oxides Using Krypton as an Ion Generating Feeding Gas

InactiveUS20070281105A1Improve abilitiesImprove efficiencyChemical vapor deposition coatingPlasma techniqueKryptonHigh density

An atomic layer deposition system and method utilizing radicals generated from a high-density mixed plasma for deposition is disclosed. A high-quality oxide or oxynitride can be deposited by exposing a substrate to a first precursor which is adsorbed onto the substrate during a first phase of one deposition cycle. After purging the deposition chamber, the substrate is exposed to a second precursor which includes oxygen radicals and krypton ions formed from the high-density mixed plasma. The ions and radicals are formed by introducing a radical generating feed gas (e.g., O2) and an ion generating feed gas into a plasma chamber and exciting the gases to form the high-density mixed plasma. The radicals and ions are then introduced to the substrate where they react with the first precursor to deposit a layer of the desired film. Krypton is preferably used as the ion generating feed gas because the metastable states of krypton lead to an efficient dissociation of oxygen into oxygen radicals when compared with other inert gases.

Owner:SANDISK TECH LLC

Flash Heating in Atomic Layer Deposition

InactiveUS20070281082A1Control performanceSave stepsSolid-state devicesPretreated surfacesMetallurgyAtomic layer deposition

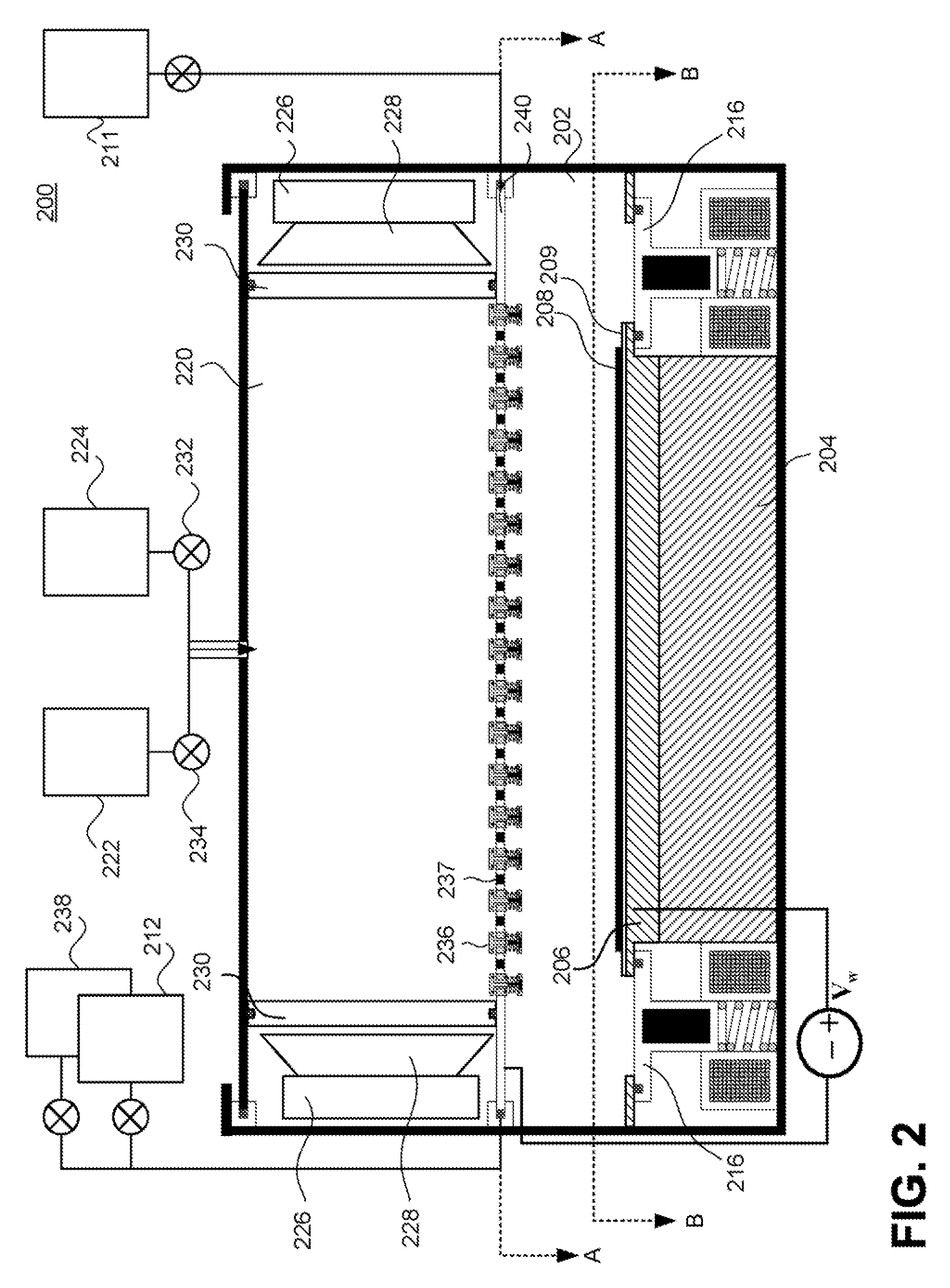

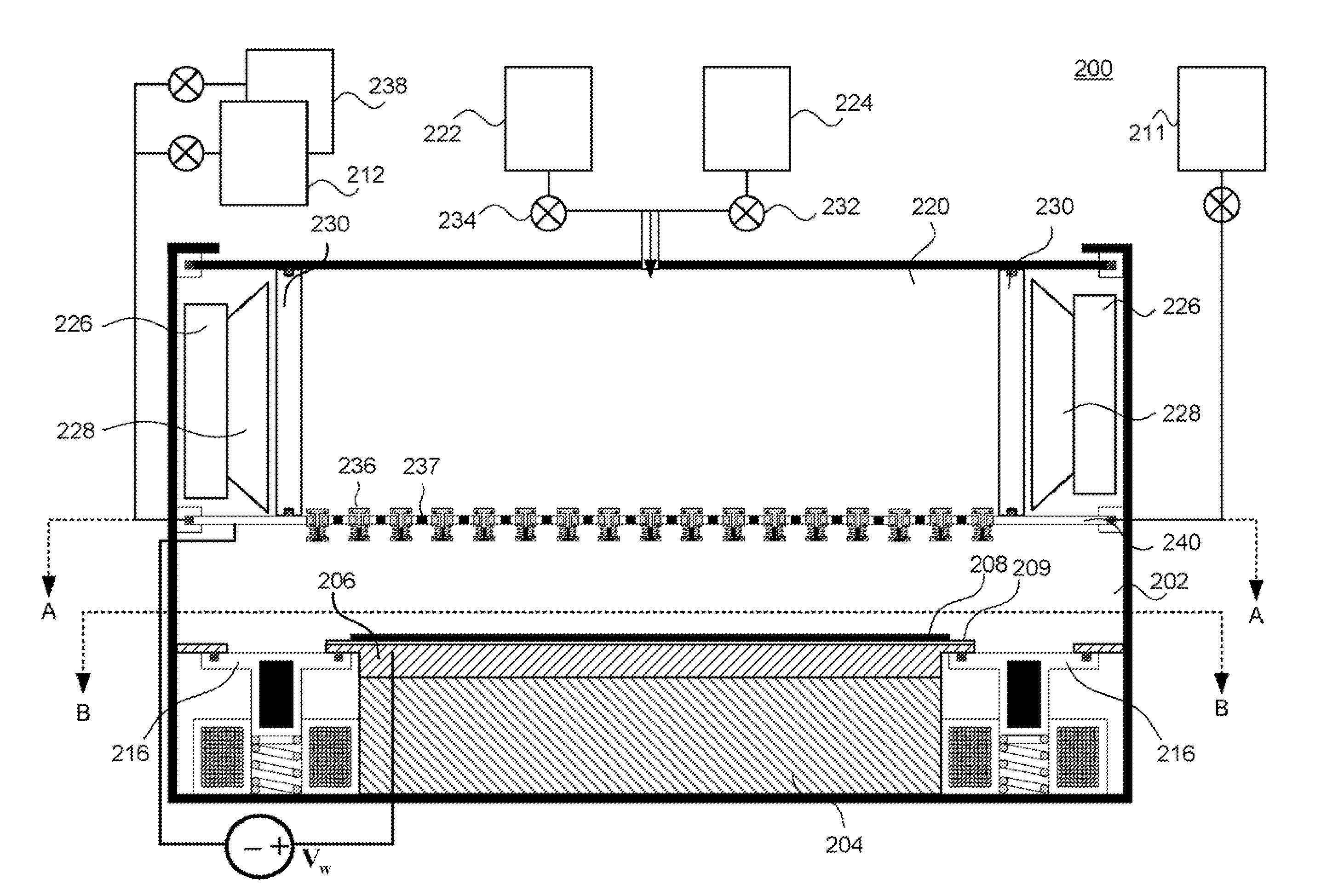

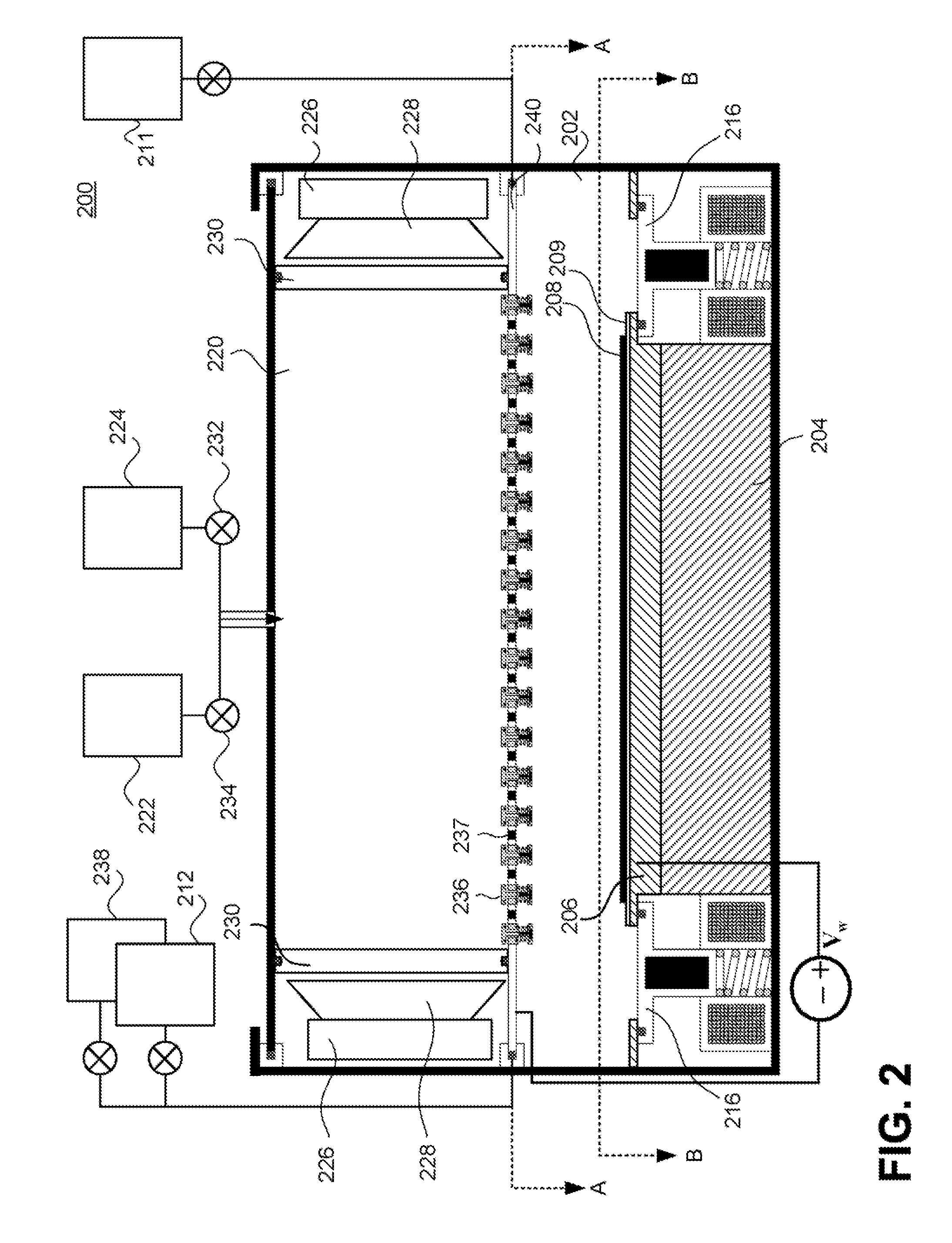

System and methods for flash heating of materials deposited using atomic layer deposition techniques are disclosed. By flash heating the surface of the deposited material after each or every few deposition cycles, contaminants such as un-reacted precursors and byproducts can be released from the deposited material. A higher quality material is deposited by reducing the incorporation of impurities. A flash heating source is capable of quickly raising the temperature of the surface of a deposited material without substantially raising the temperature of the bulk of the substrate on which the material is being deposited. Because the temperature of the bulk of the substrate is not significantly raised, the bulk acts like a heat sink to aid in cooling the surface after flash heating. In this manner, processing times are not significantly increased in order to allow the surface temperature to reach a suitably low temperature for deposition.

Owner:SANDISK TECH LLC

Information processing device, method, program, and integrated circuit

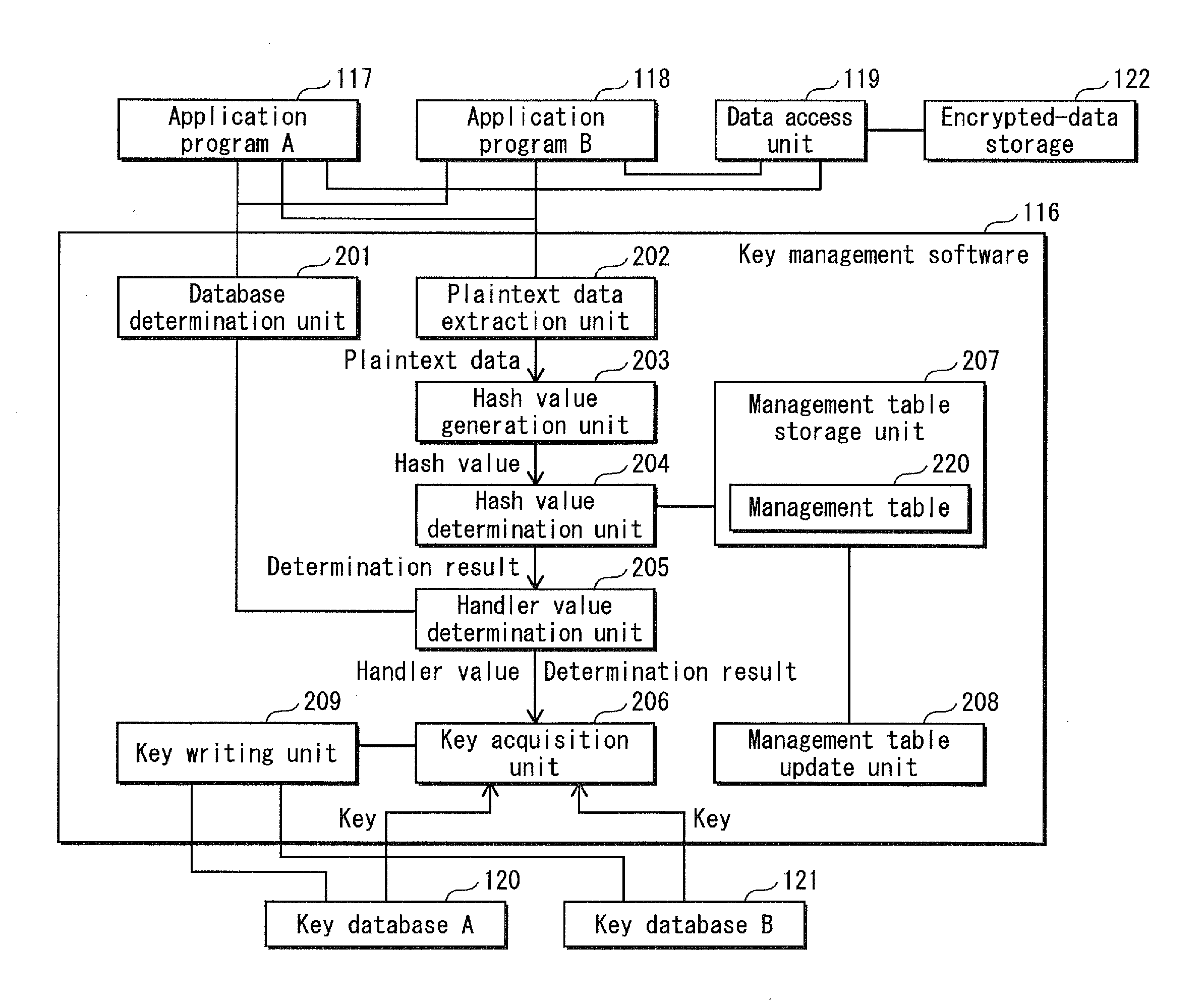

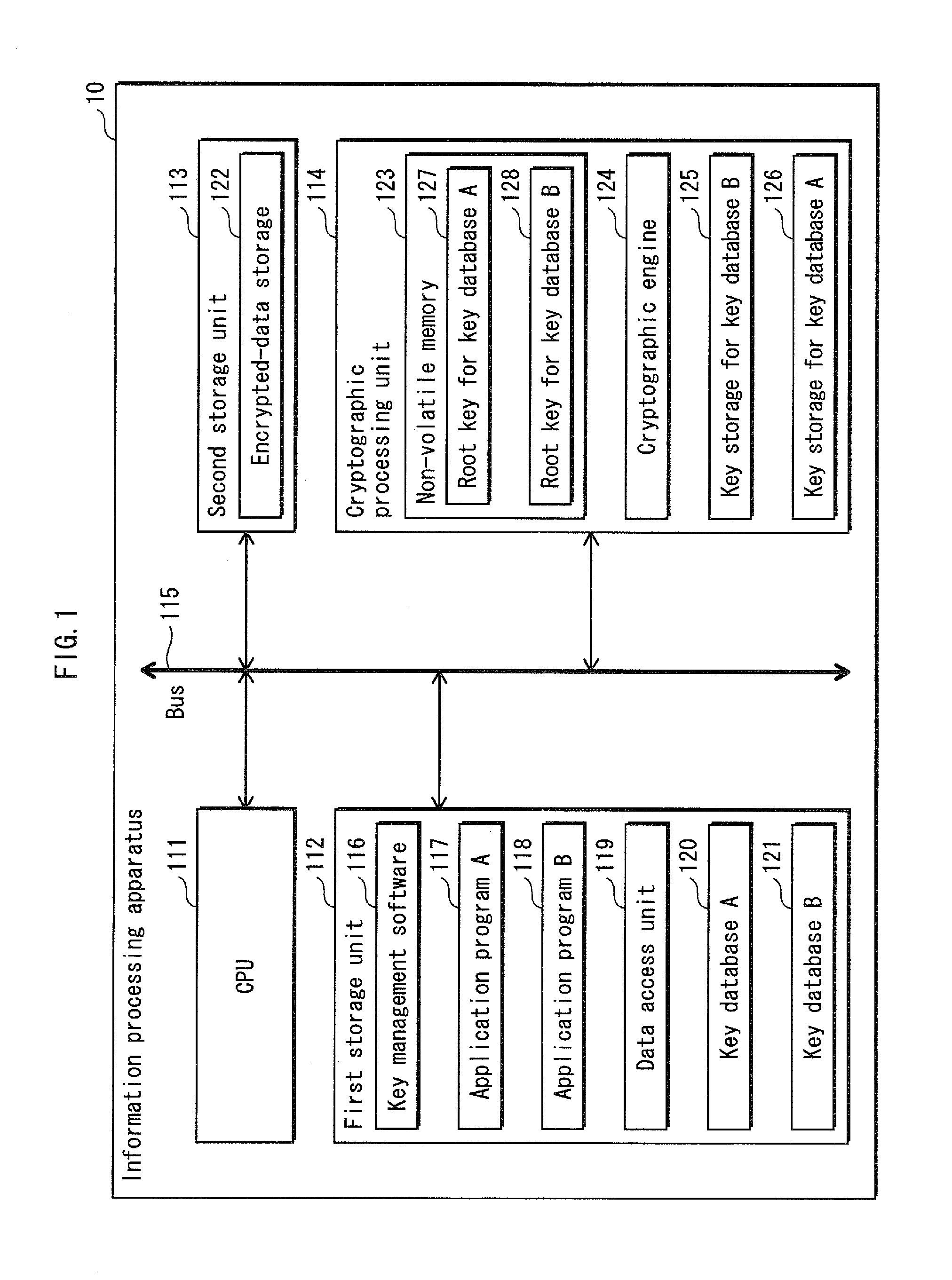

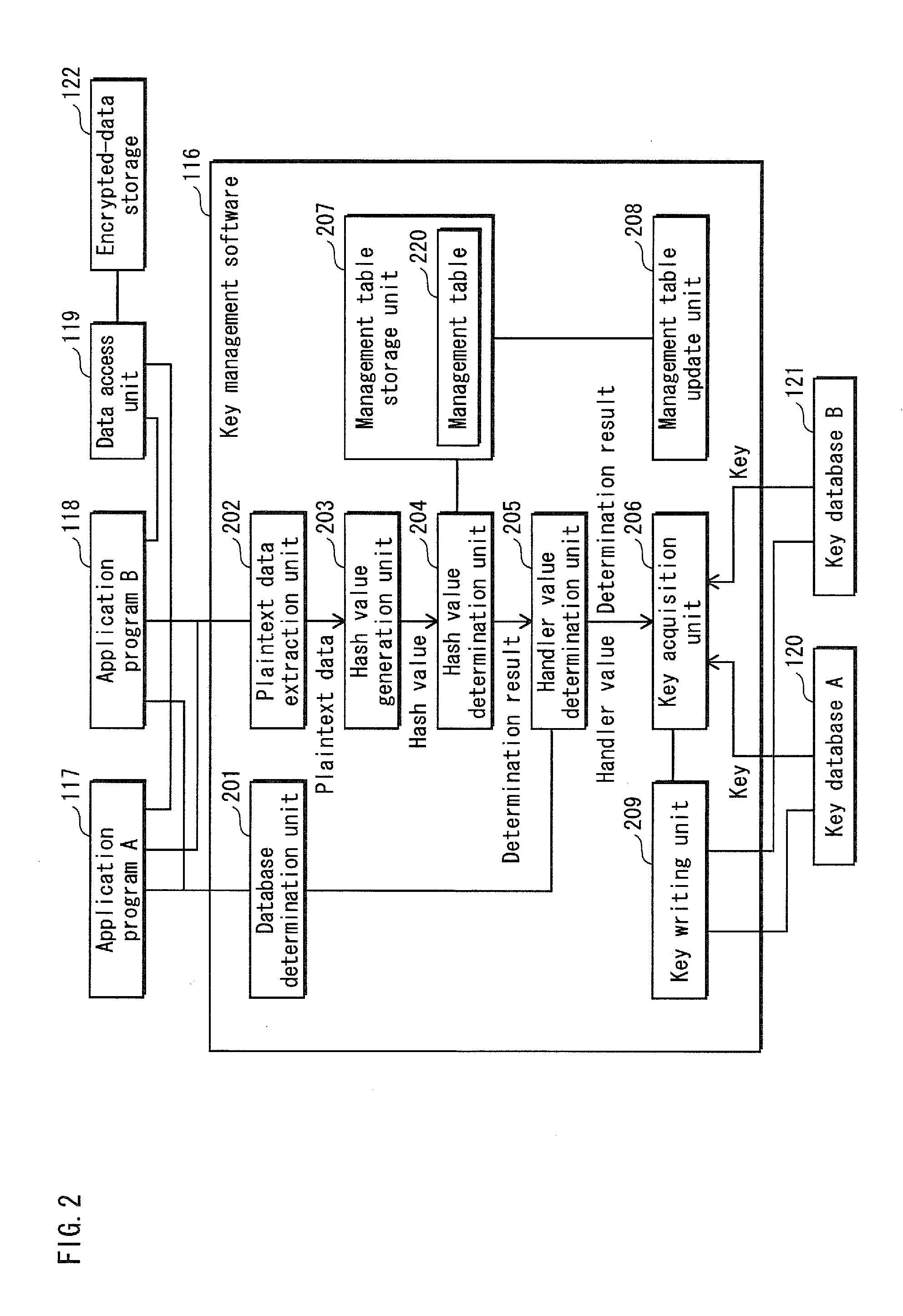

InactiveUS20110173460A1Save stepGood synchronizationUnauthorized memory use protectionHardware monitoringTree structureSoftware

The aim is to provide high-speed data synchronization. To achieve the aim, in data synchronization using a plurality of key databases with respect to same data pieces, a key for one key database, which has been determined in advance, is used for updating the data piece managed under the other key database. This reduces the number of key decryption operations. A key management software 116, which manages a key database A120 and a key database B121 each having a tree structure, determines whether to perform data synchronization when requested by an upper-level application to perform data encryption, and performs synchronization of encrypted data by using a key of the other database which has been determined in advance. This reduces the number of times the encrypted key is loaded onto a cryptographic processing unit 114, and realizes high-speed cryptographic processing on data.

Owner:PANASONIC CORP

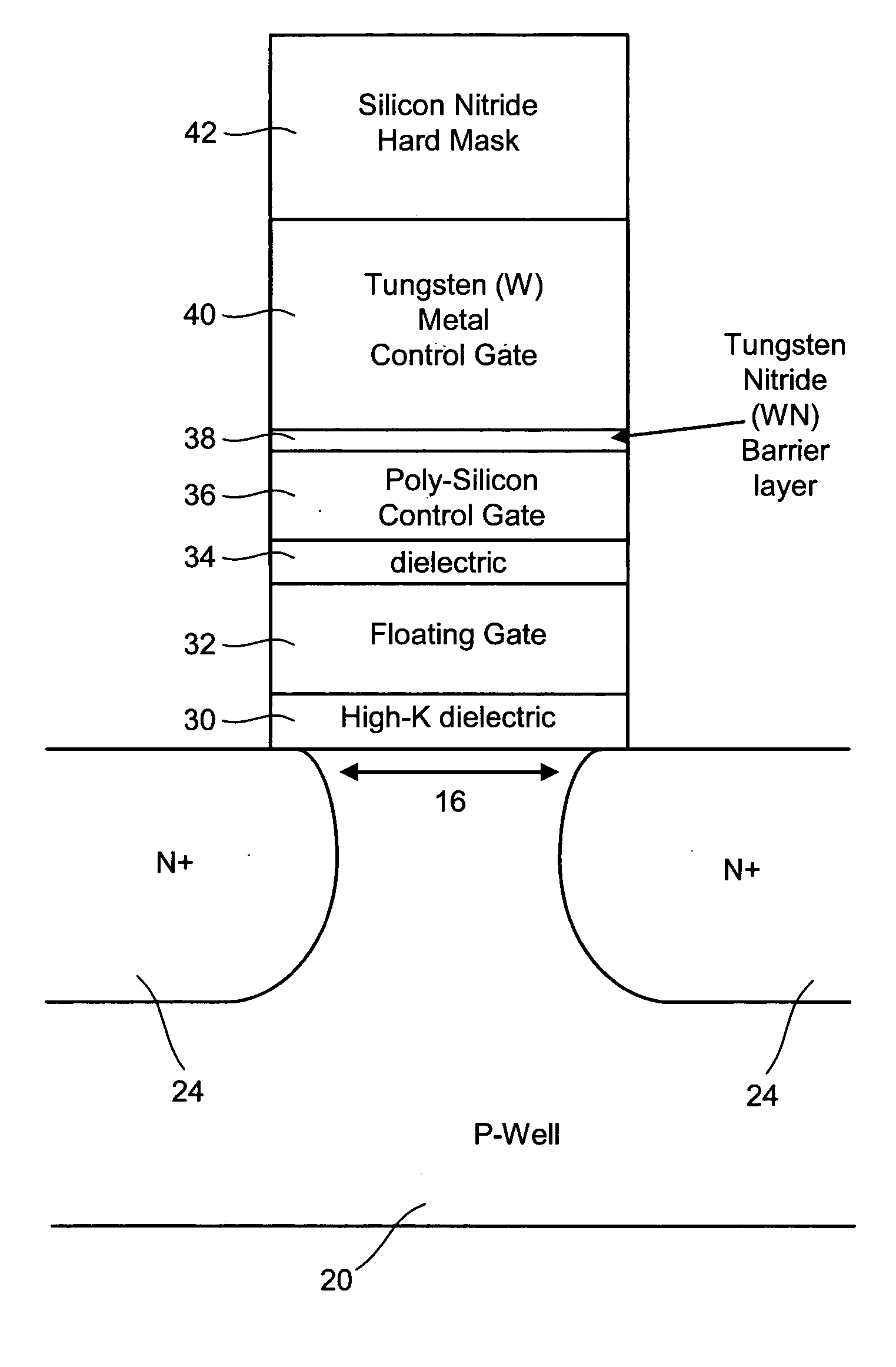

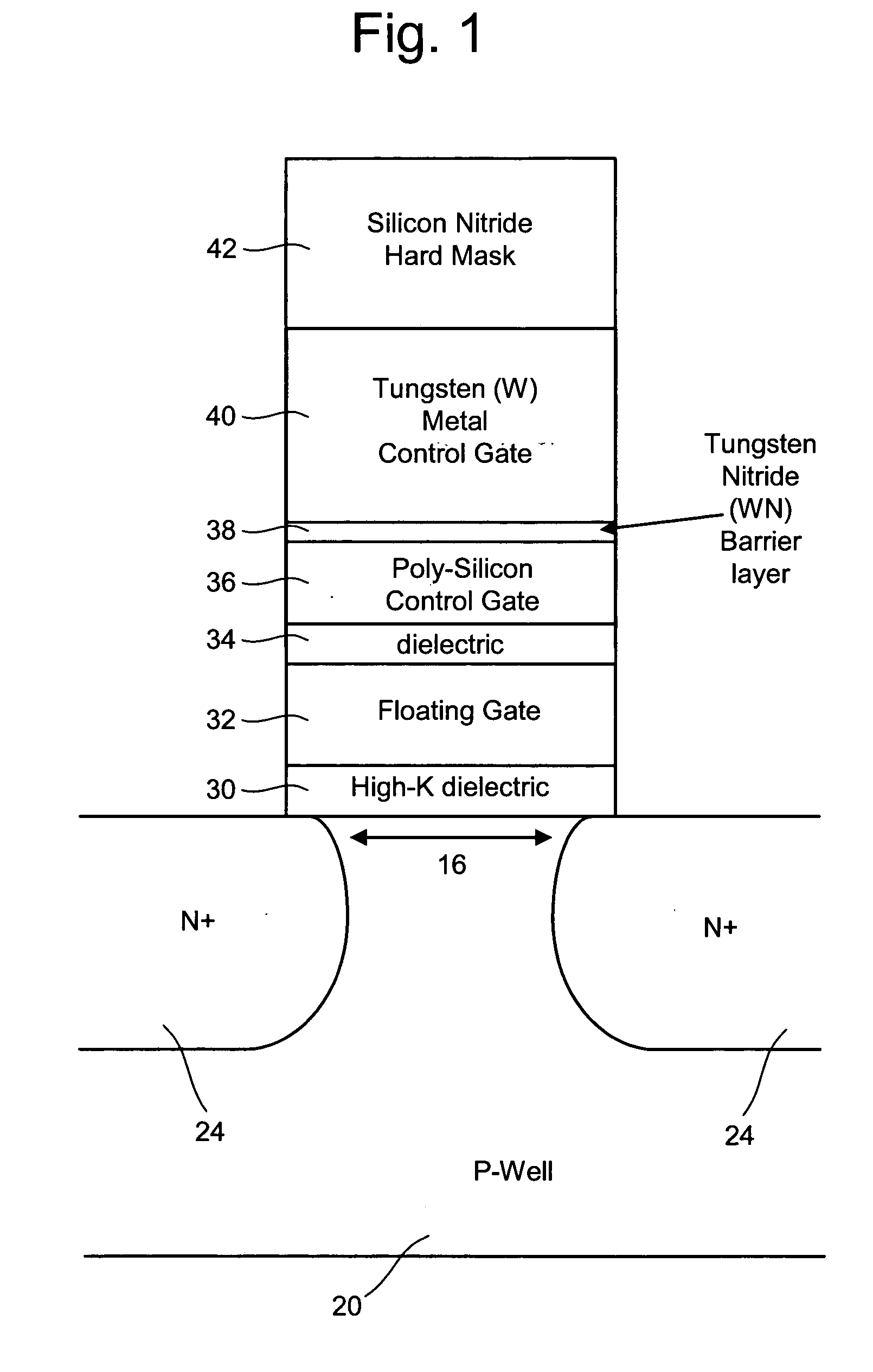

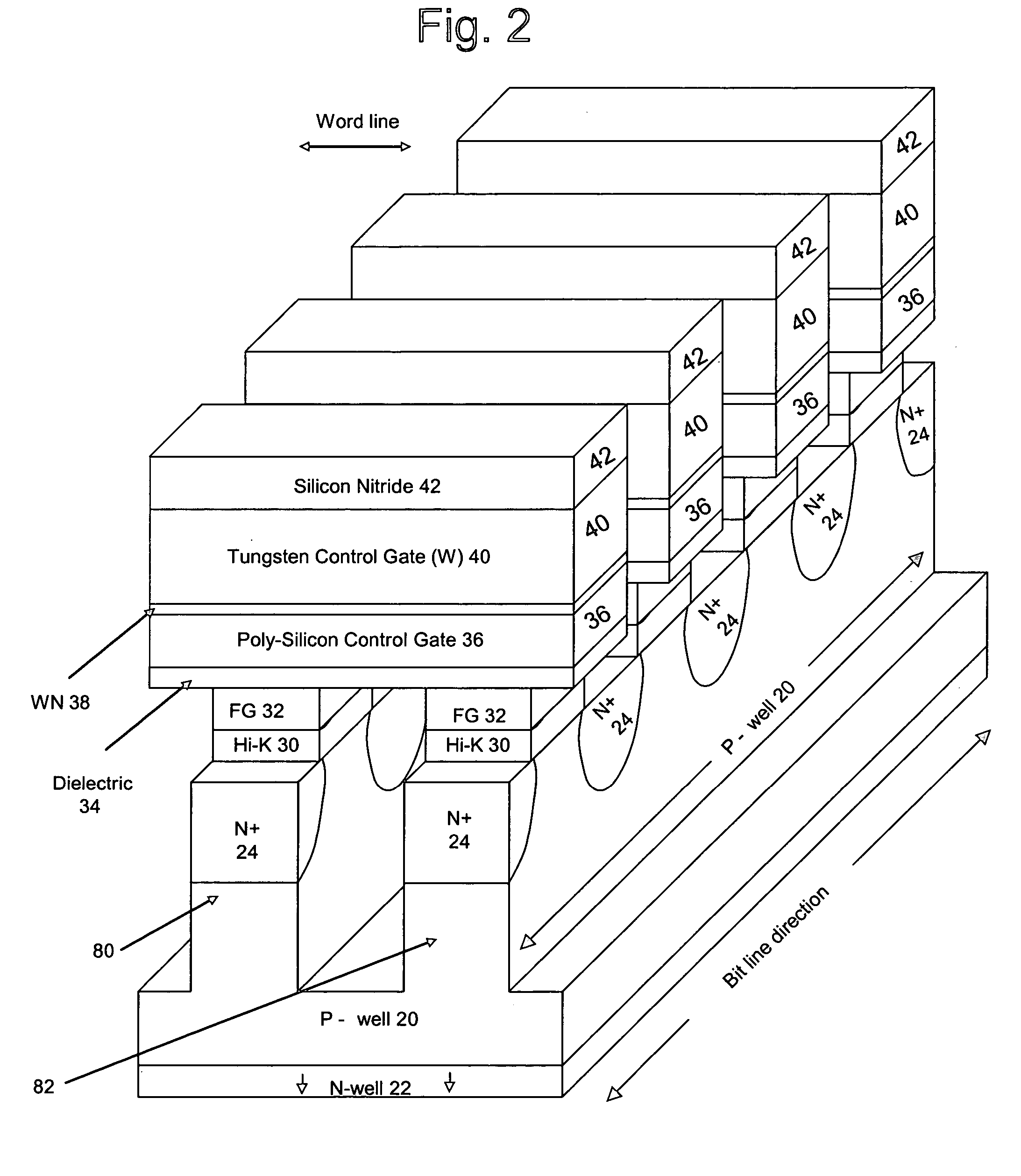

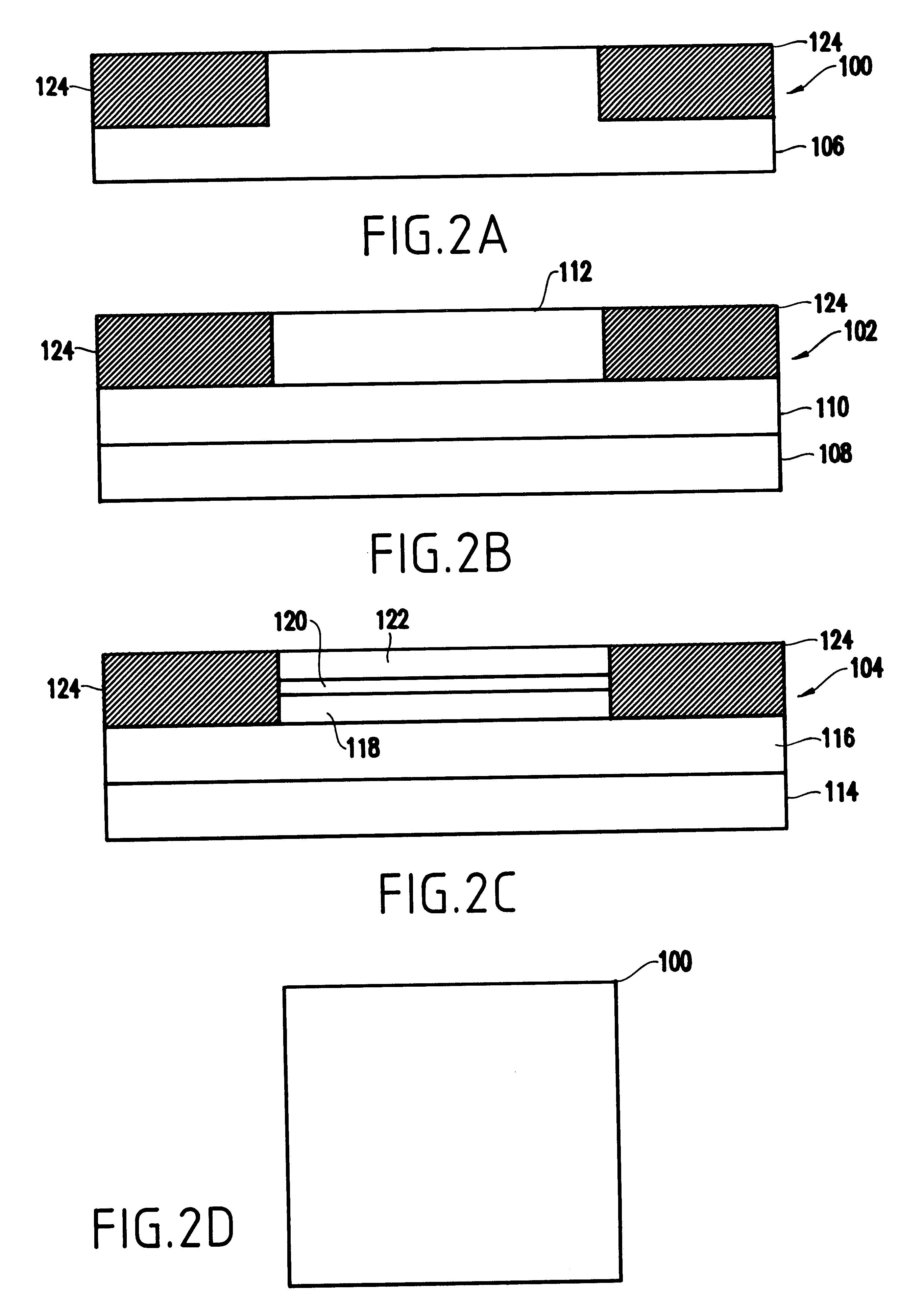

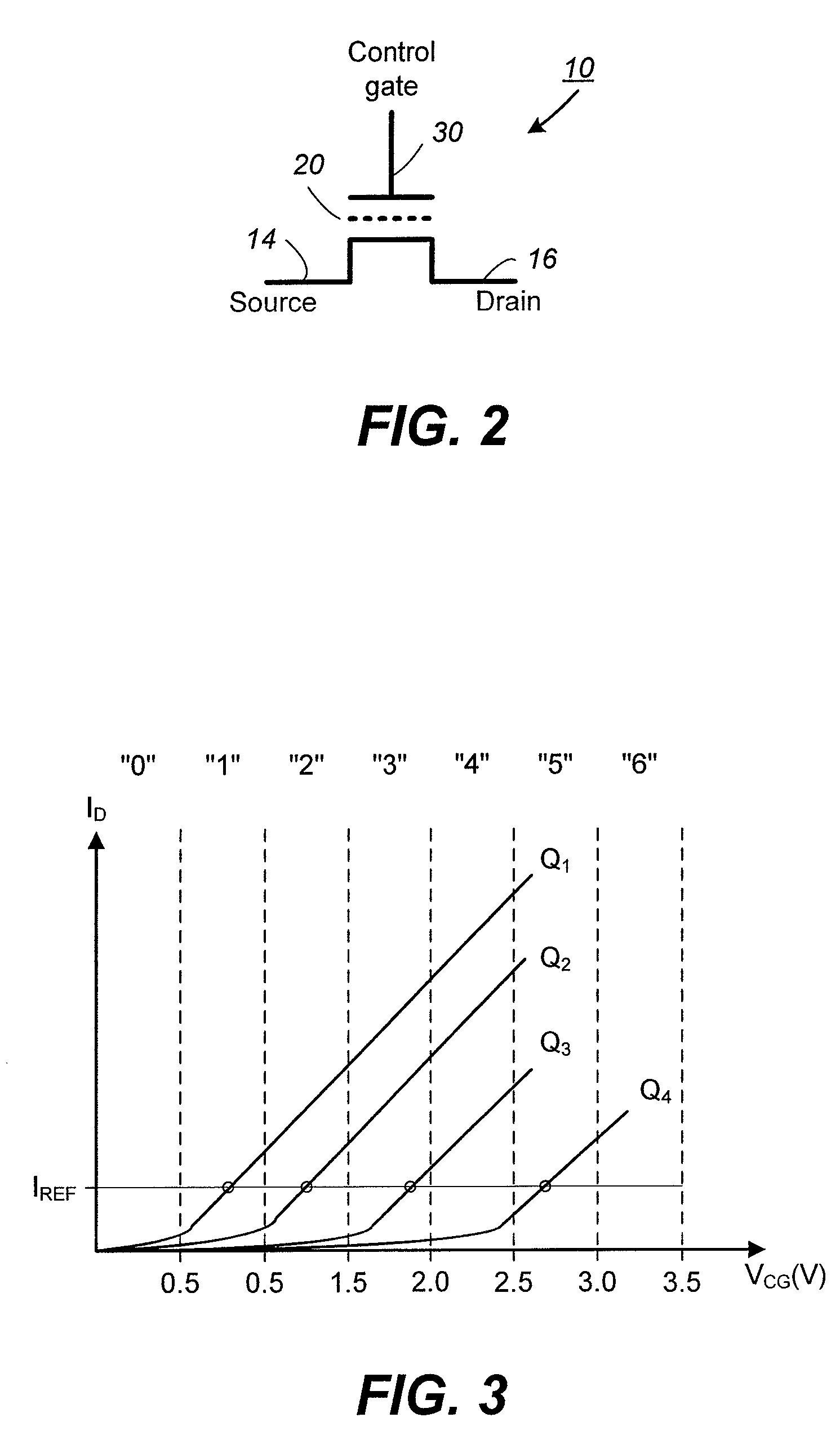

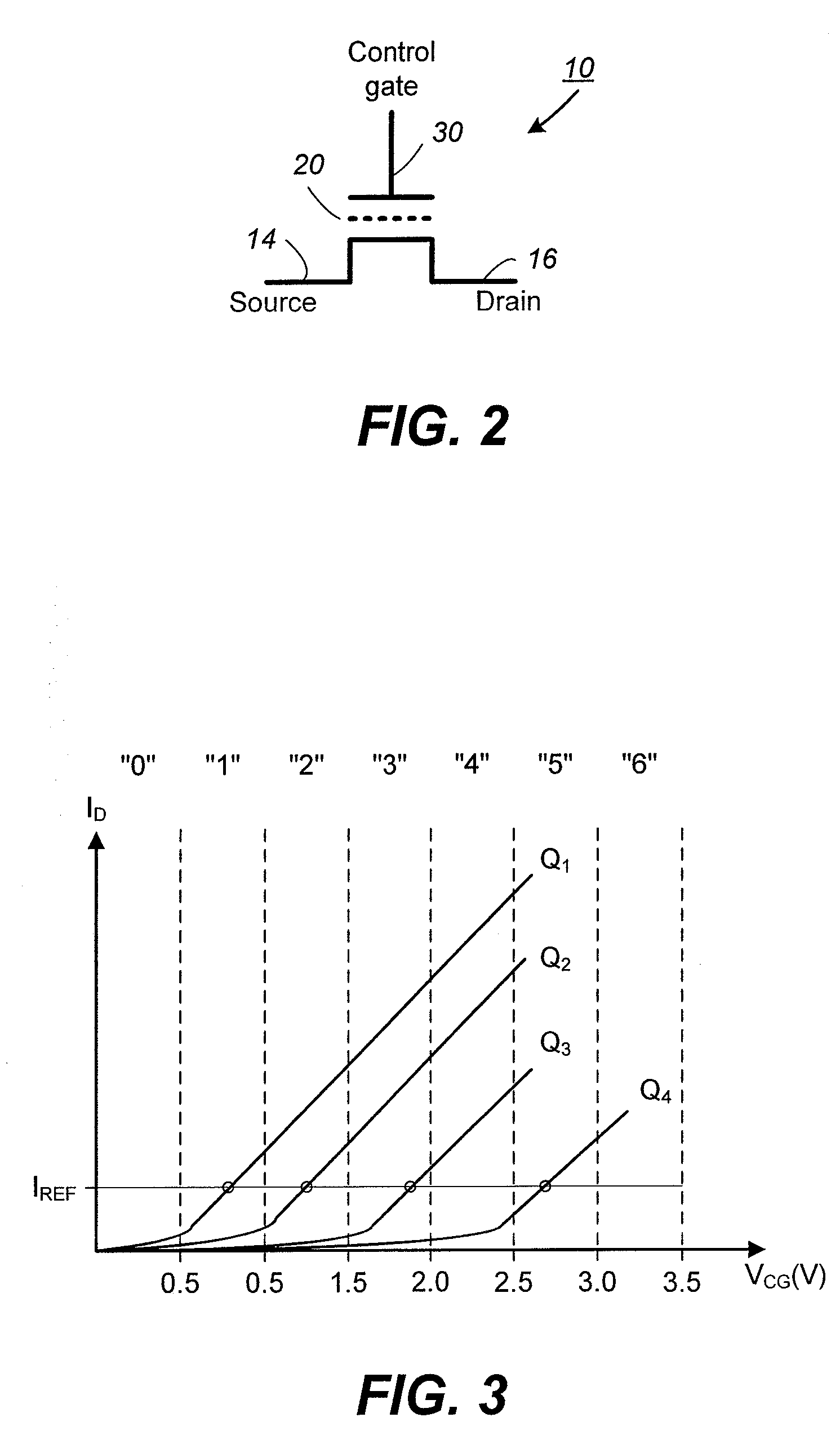

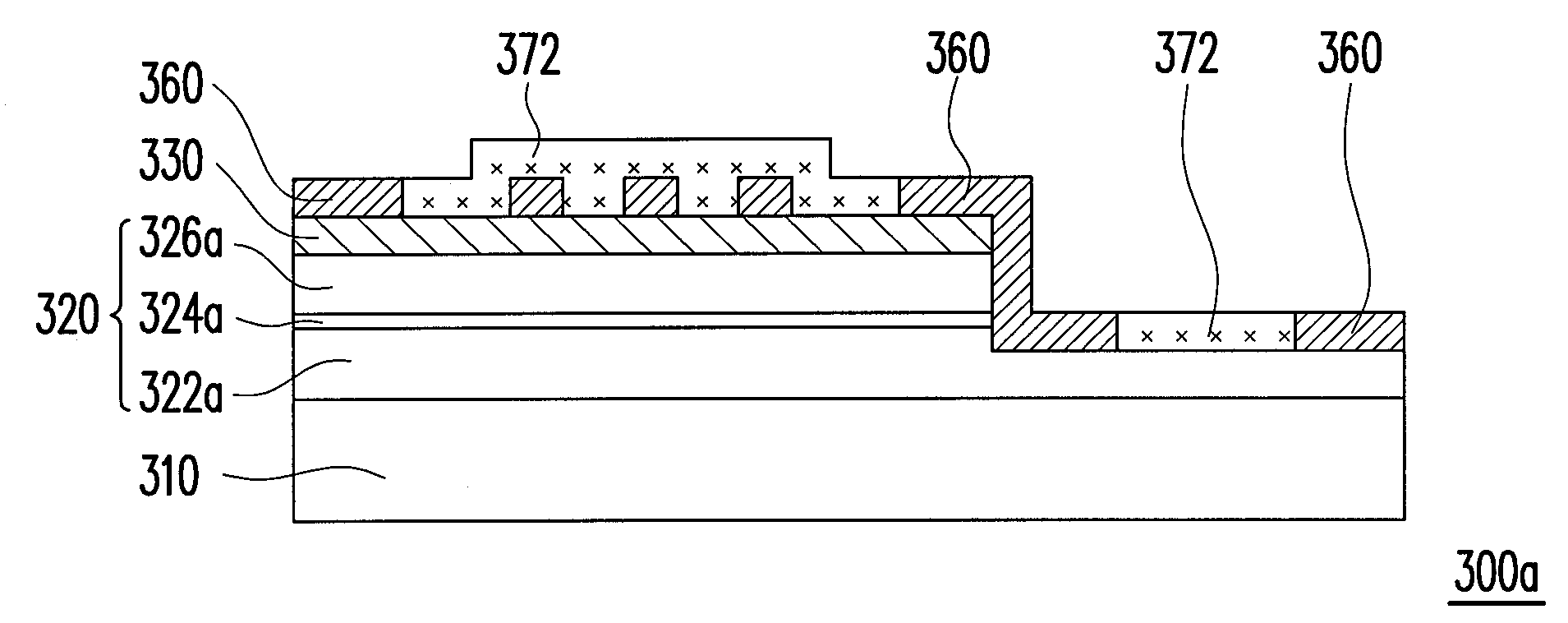

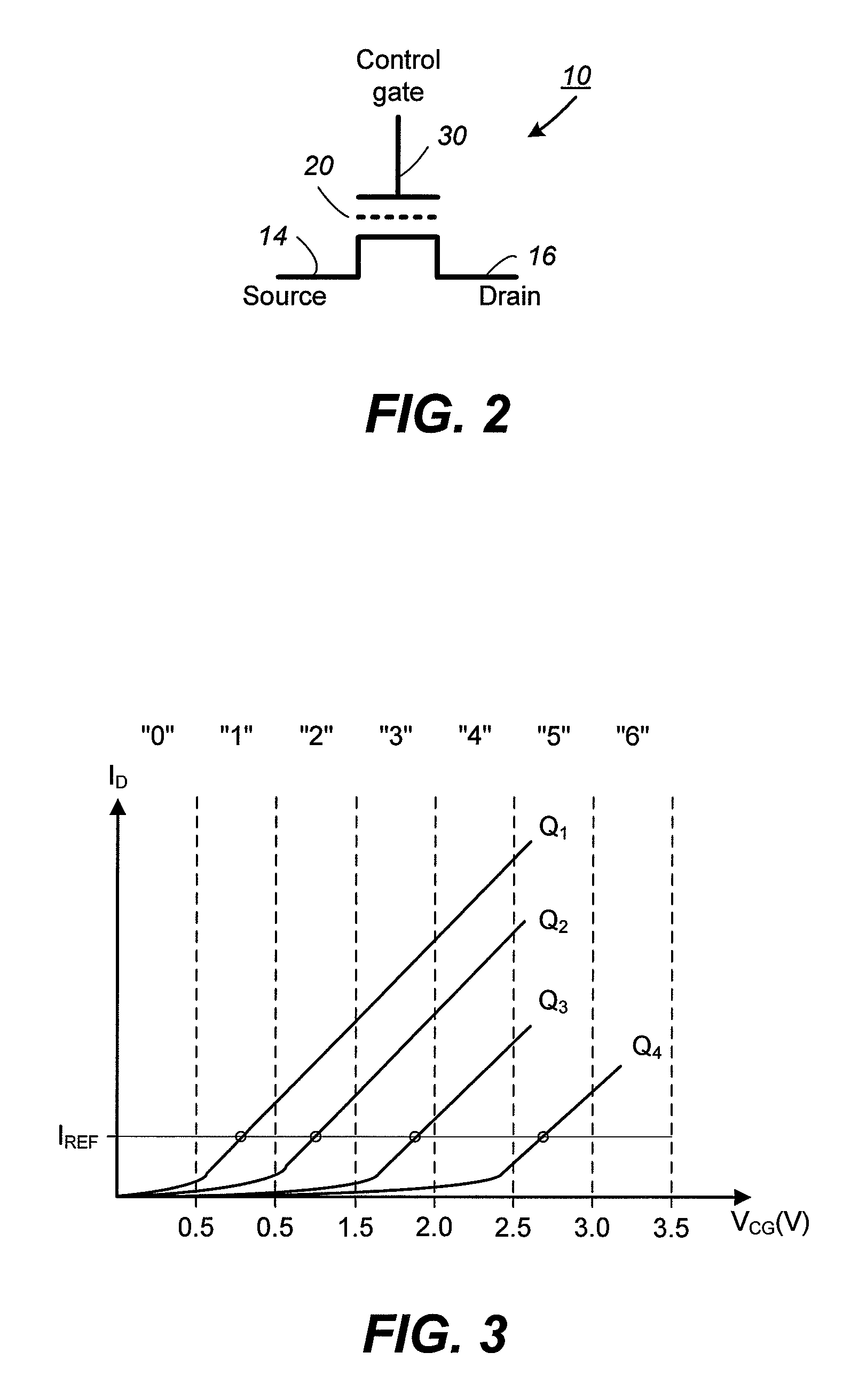

Non-volatile memory cell using high-k material and inter-gate programming

ActiveUS20050157549A1Improve performanceReduce Shrinkage ProblemsTransistorSolid-state devicesDielectricNon-volatile memory

A non-volatile memory device has a channel region between source / drain regions, a floating gate, a control gate, a first dielectric region between the channel region and the floating gate, and a second dielectric region between the floating gate and the control gate. The first dielectric region includes a high-K material. The non-volatile memory device is programmed and / or erased by transferring charge between the floating gate and the control gate via the second dielectric region.

Owner:SANDISK TECH LLC

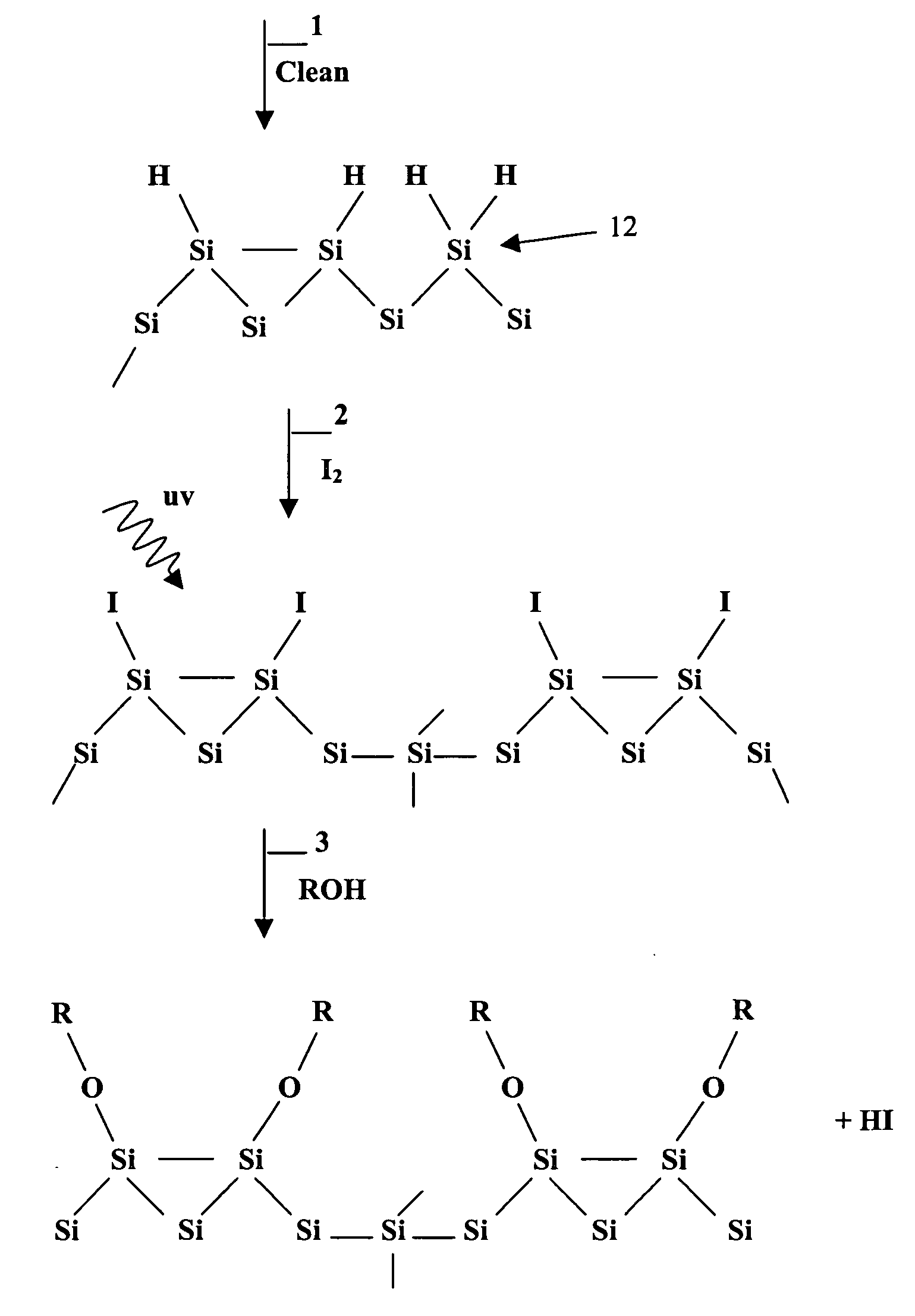

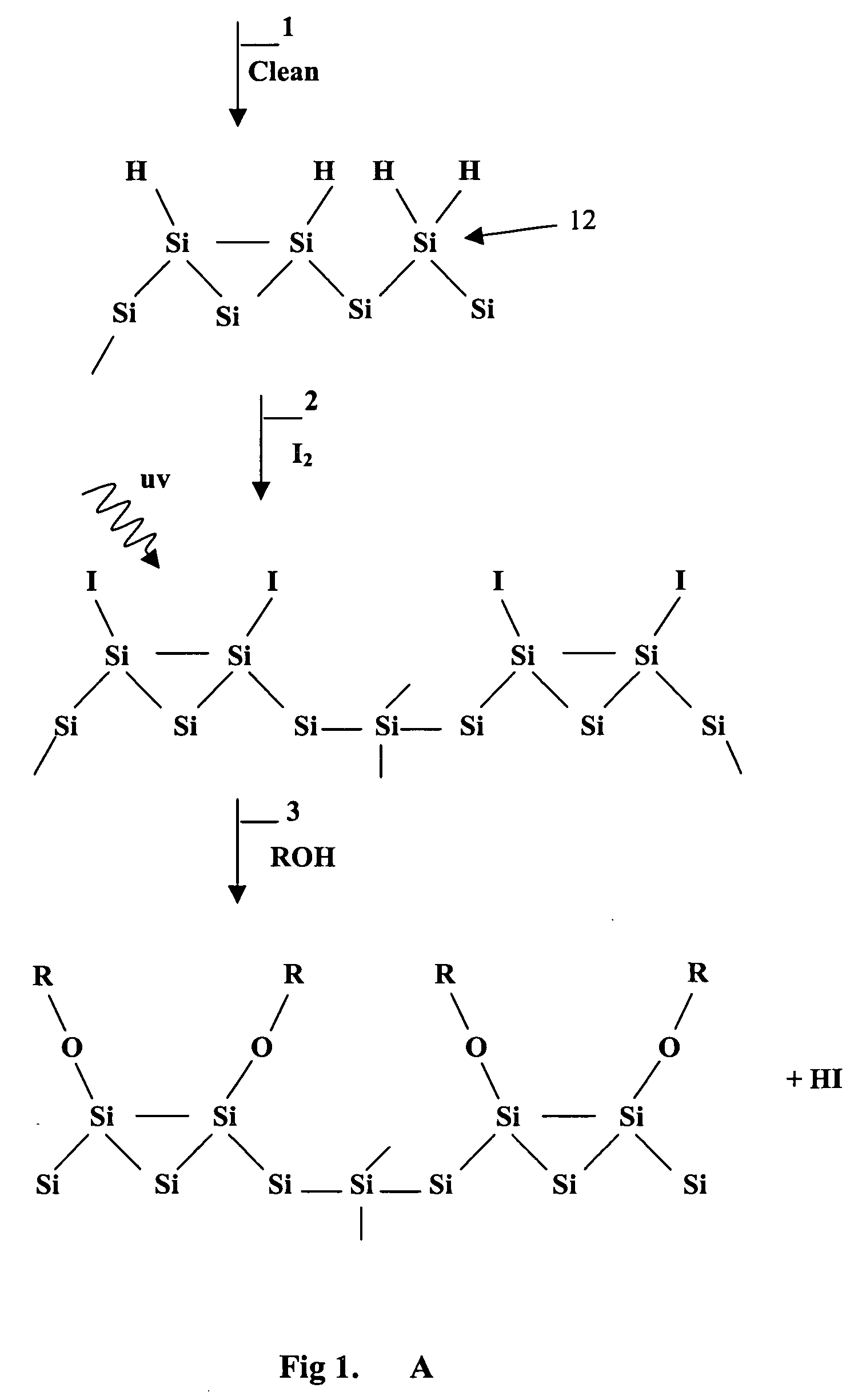

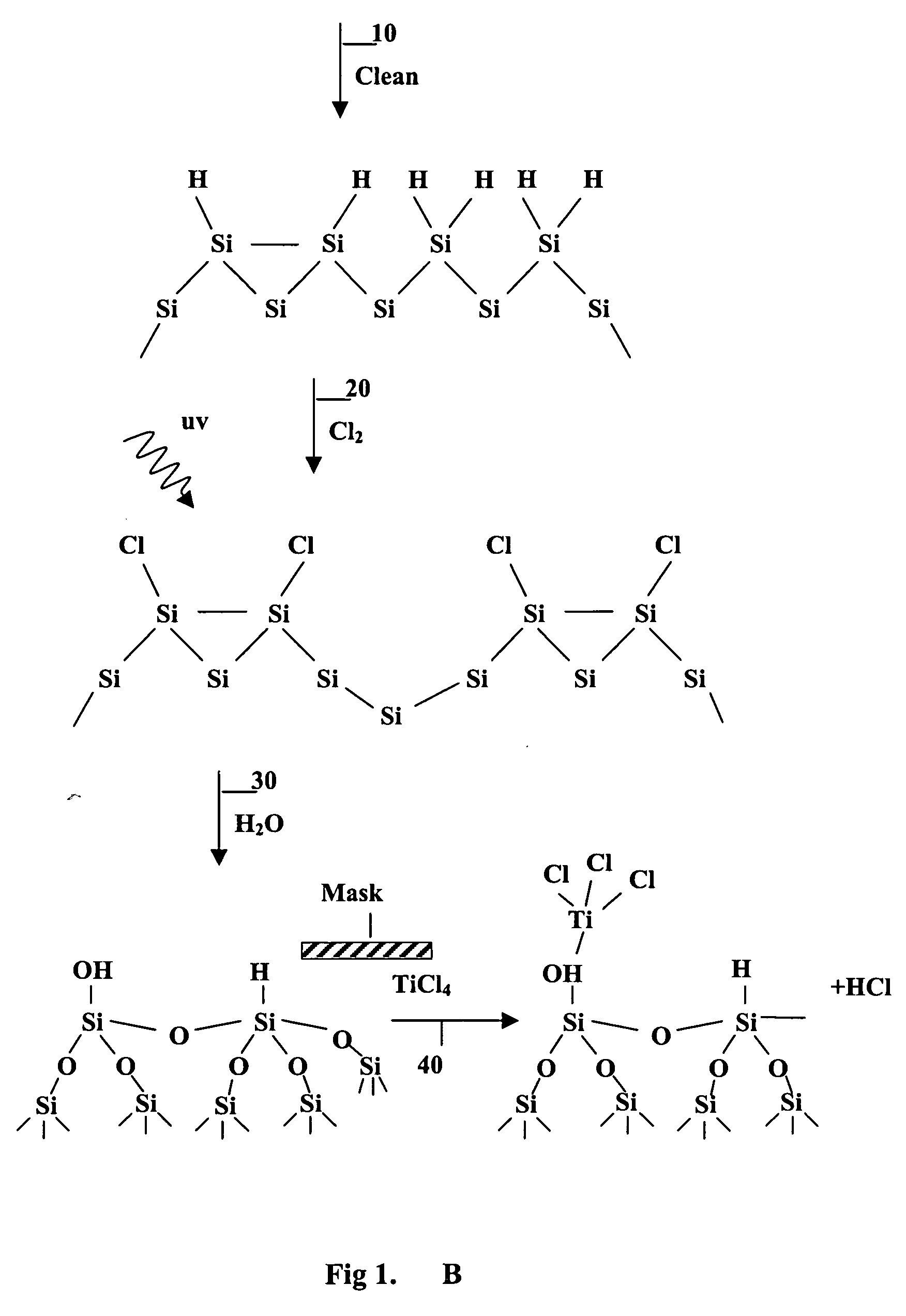

Surface manipulation and selective deposition processes using adsorbed halogen atoms

InactiveUS20060199399A1Saving process stepReduce environmental impactSemiconductor/solid-state device manufacturingChemical vapor deposition coatingElectrical conductorGas phase

The present invention provides a surface preparation process using adsorbed halogen. The halogen is applied in a gas phase with UV light. The adsorbed halogen is subsequently modified in another gas phase reaction. The halogen may be reacted with water to form a hydroxyl-bearing Si—O monolayer that forms a layer for subsequent metal deposition. In one aspect the halogen layer is reacted with an alkyl or alkoxy of the formula R-OH to form a passivation layer. By replacing hydrogen atom termination with alkoxy (e.g.methoxy termination, —OCH3). The selective deposition process can be used for passivating and depositing thin metal films on material surfaces composed of any combination of the group consisting of semiconductors, conductors, insulators, and the like.

Owner:THE ARIZONA BOARD OF REGENTS ON BEHALF OF THE UNIV OF ARIZONA

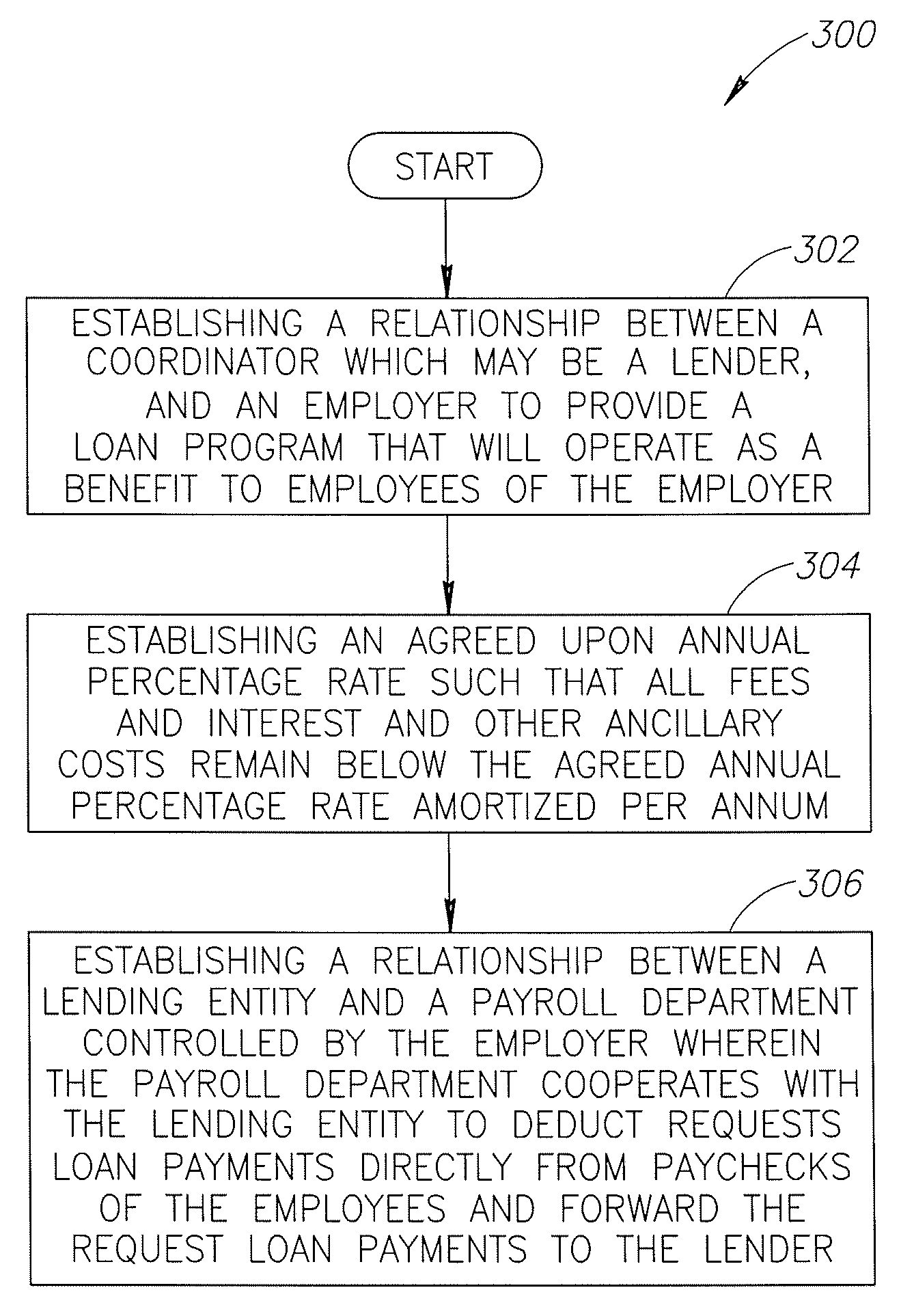

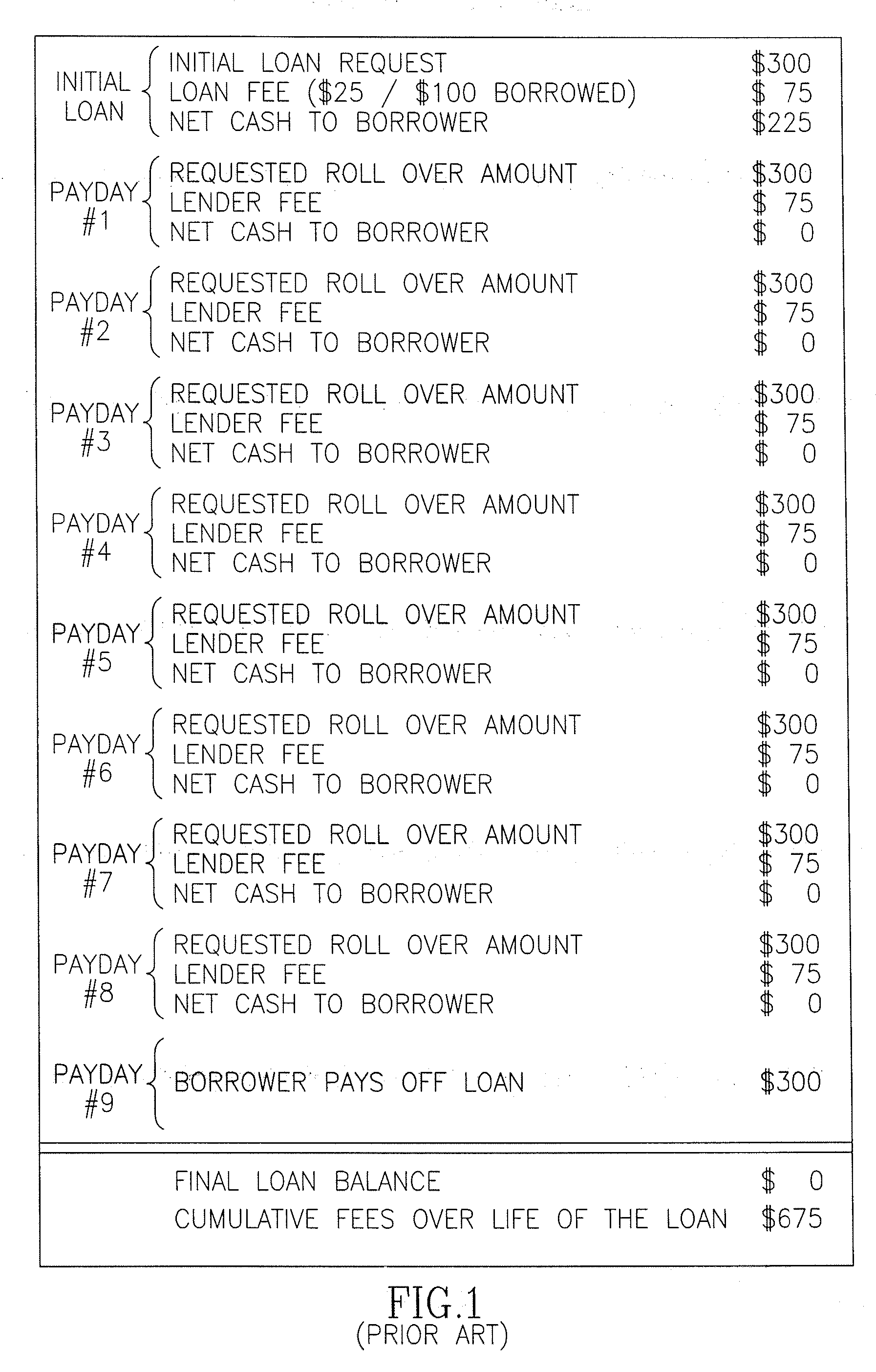

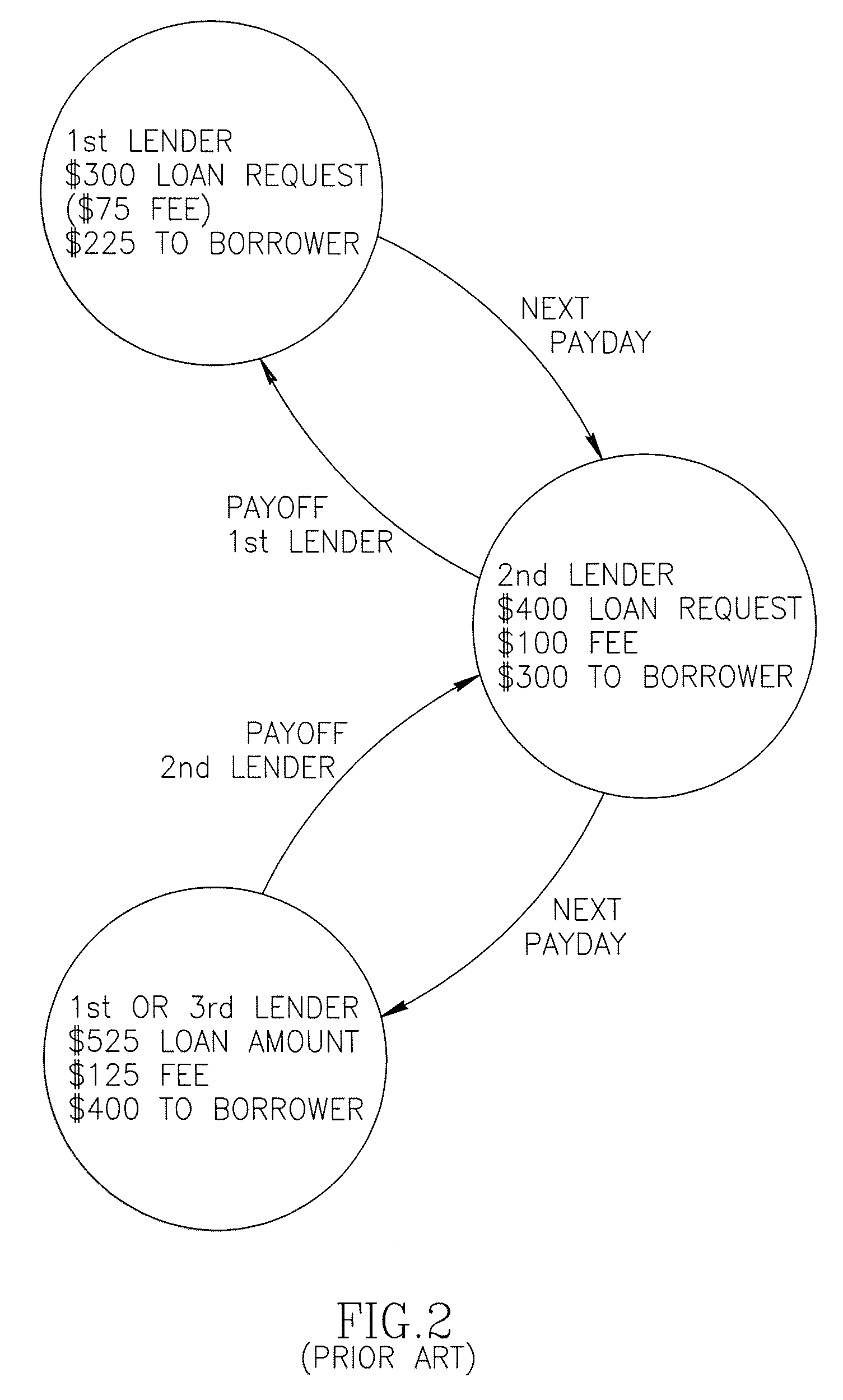

Loan program and process for transacting the same

ActiveUS20080005001A1Low costSave stepsFinancePayment architectureTelecommunicationsProgram planning

Owner:EMPLOYEE LOAN SOLUTIONS LLC

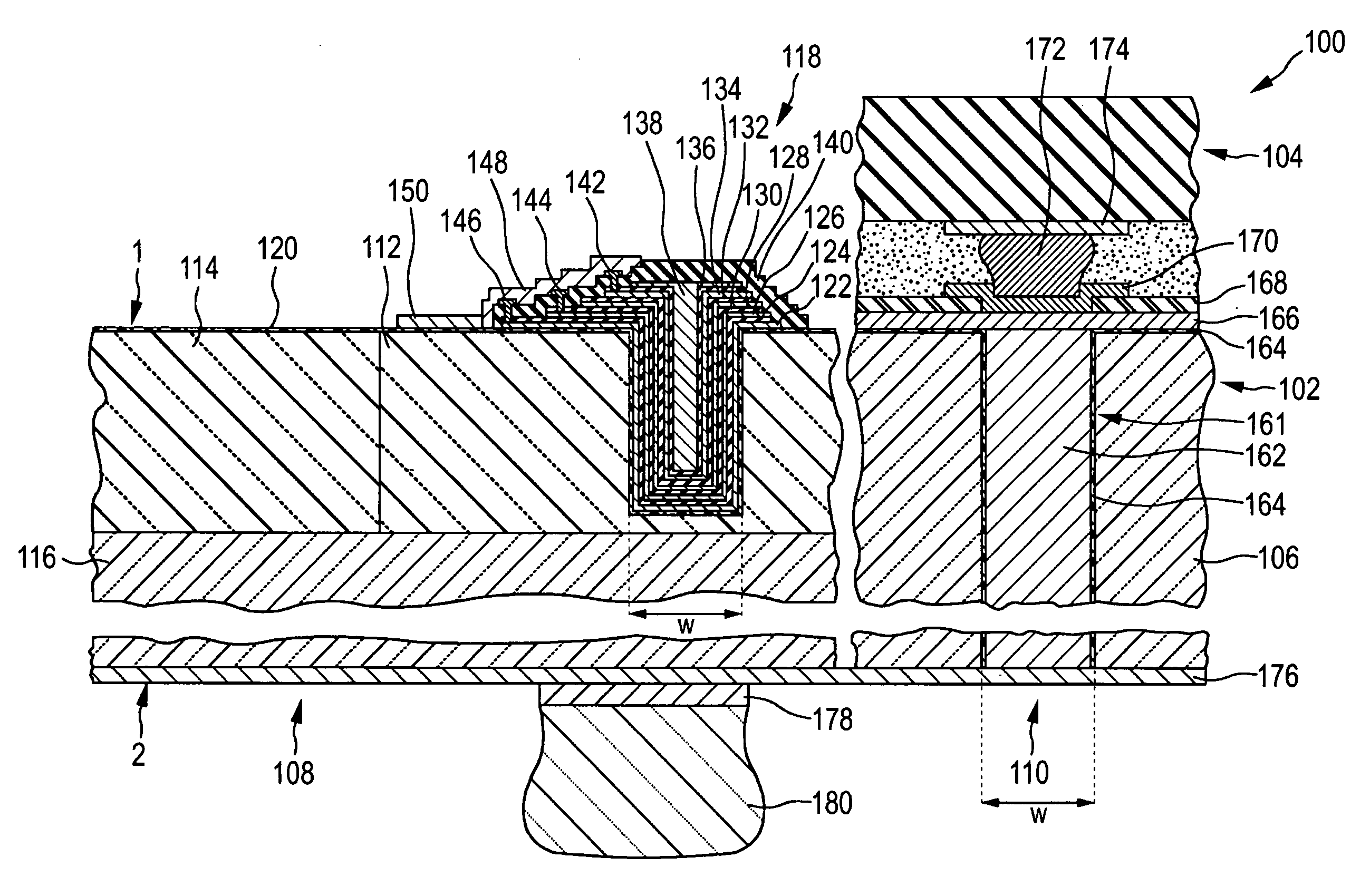

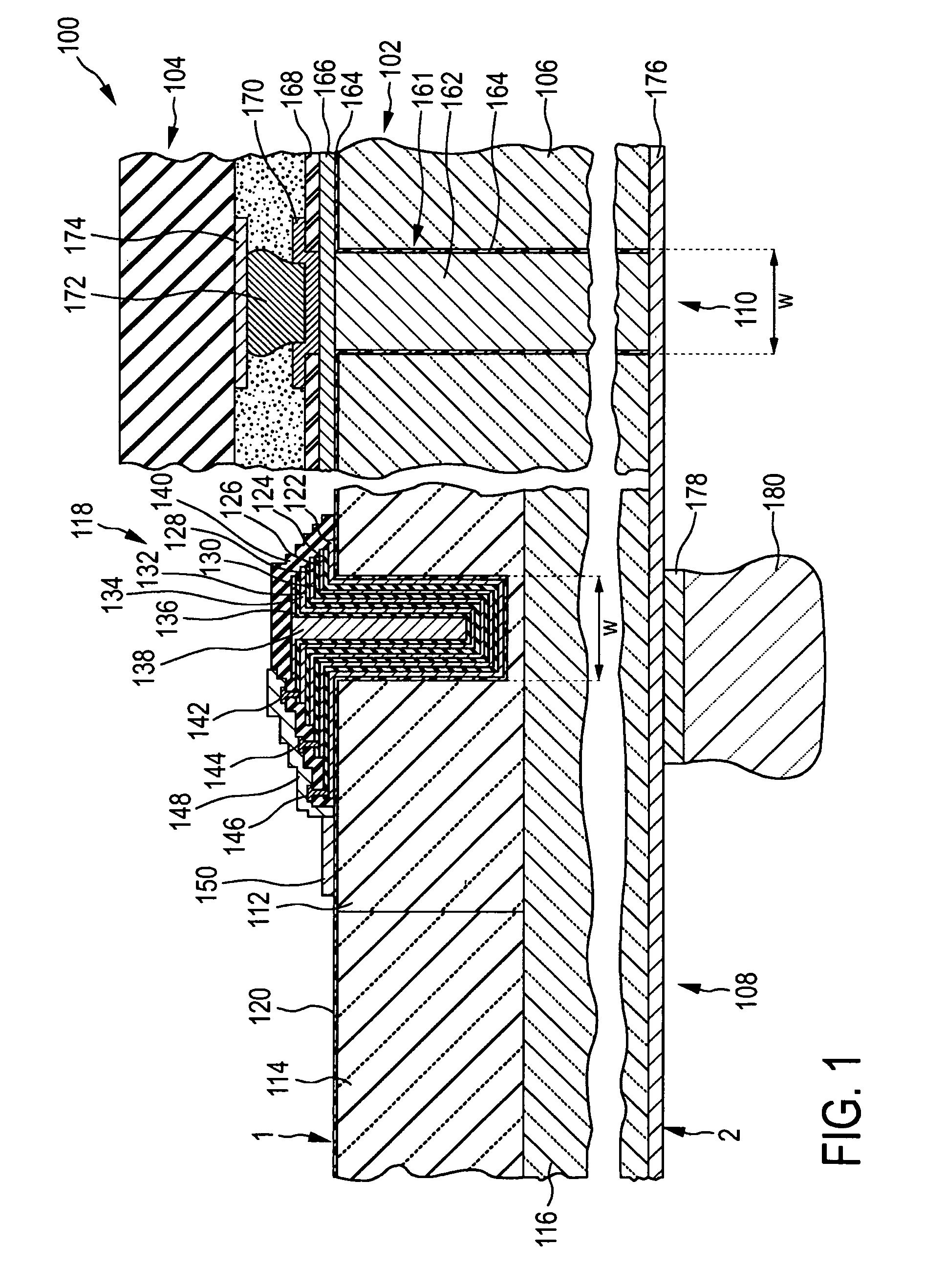

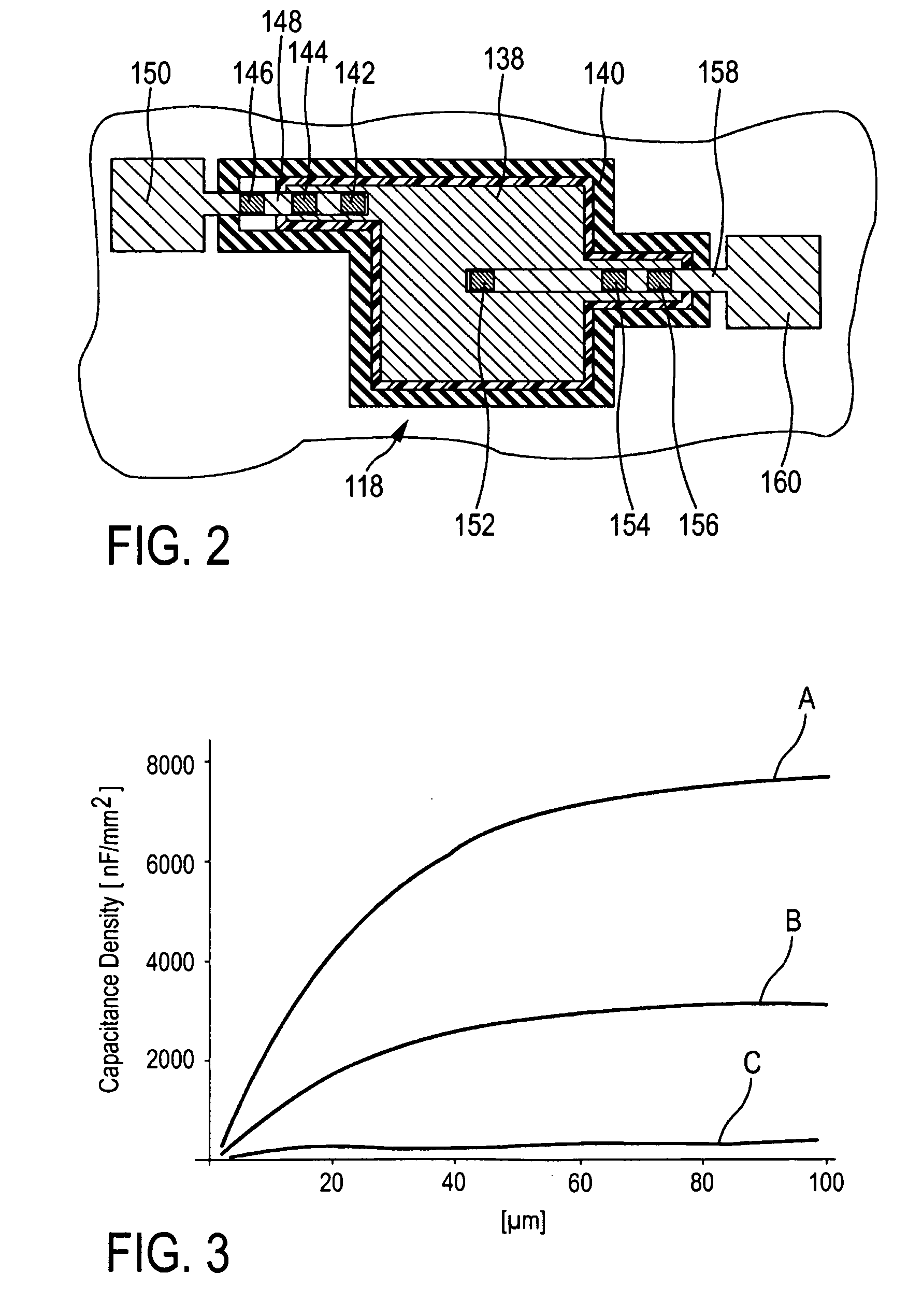

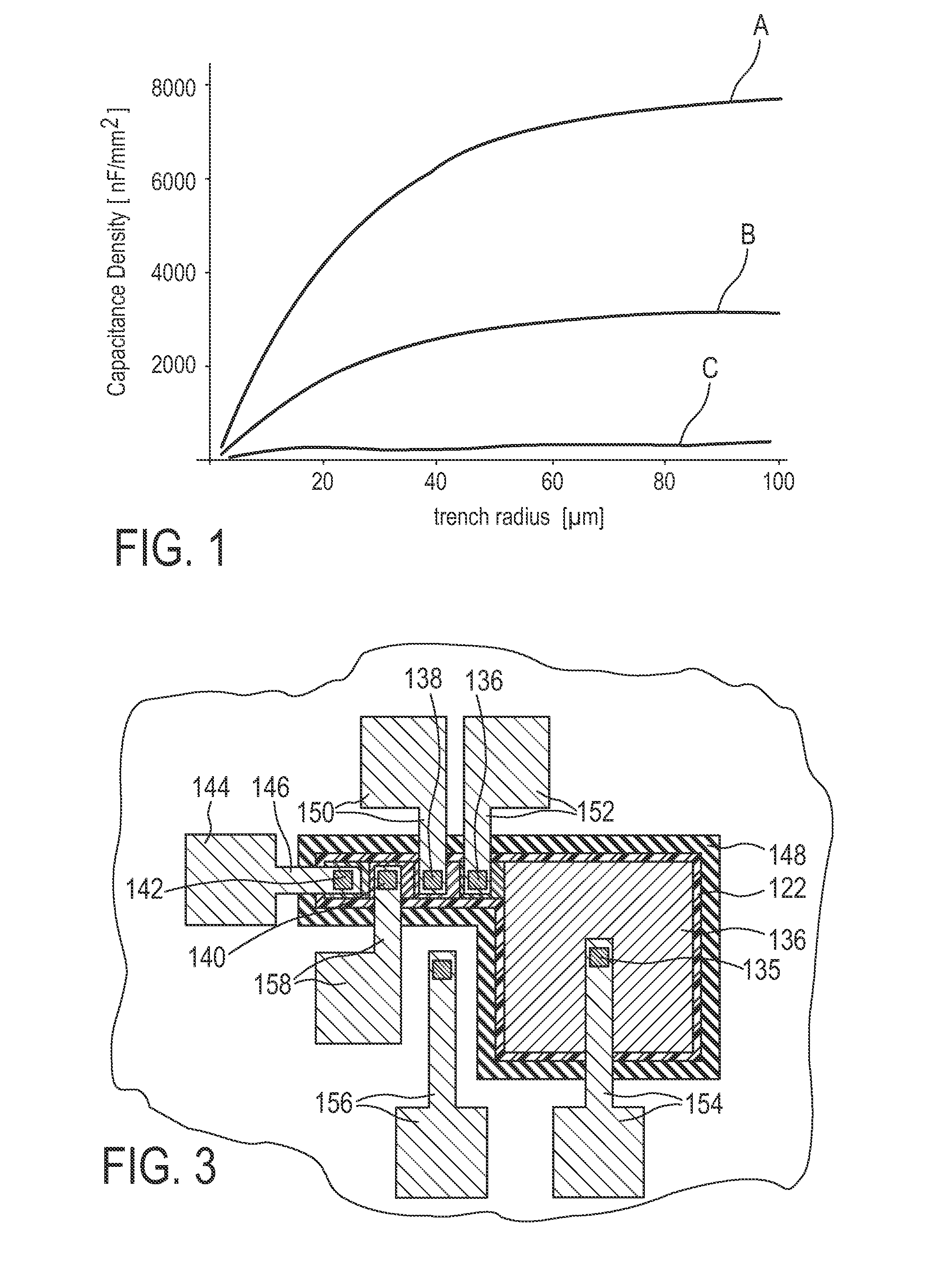

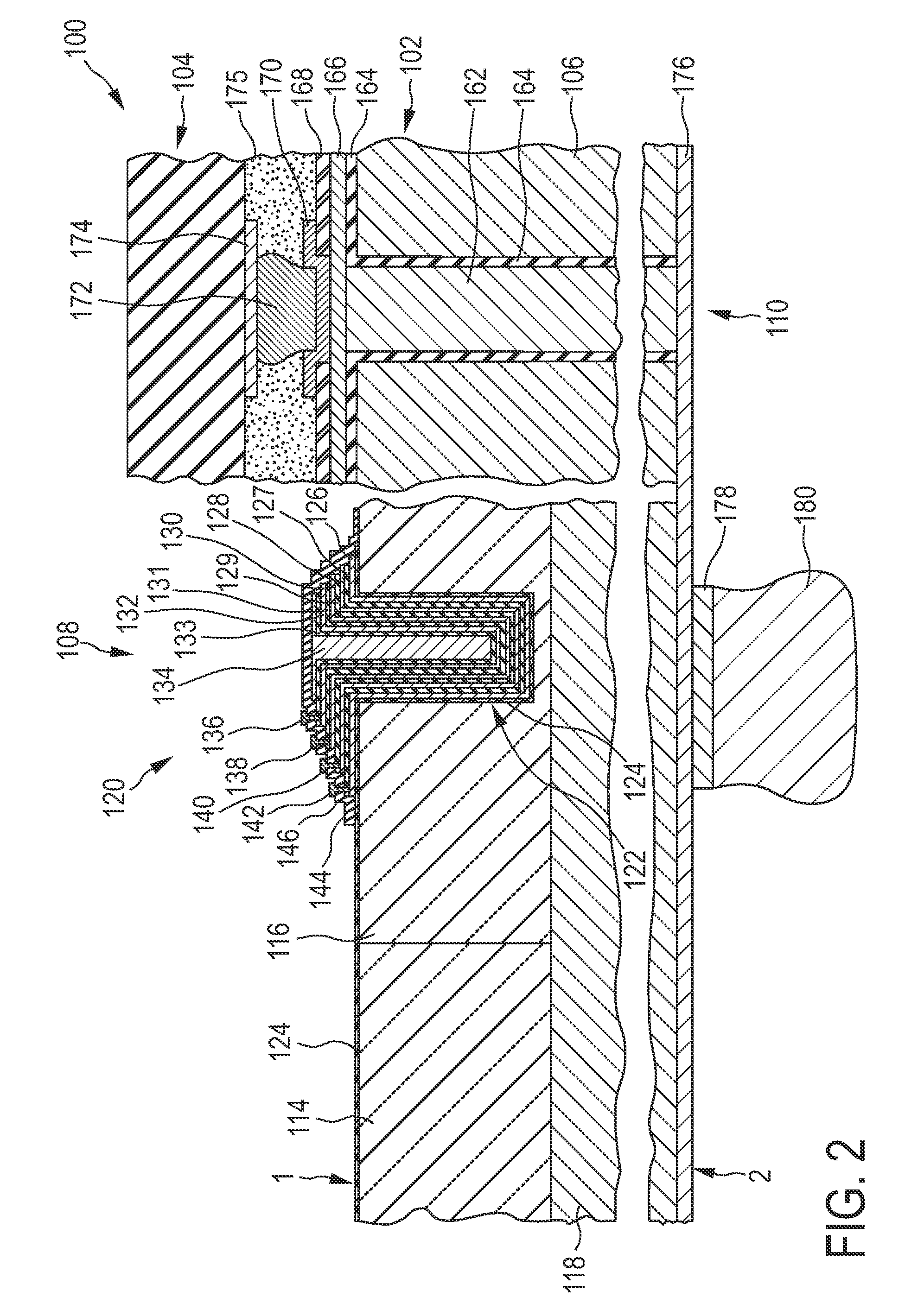

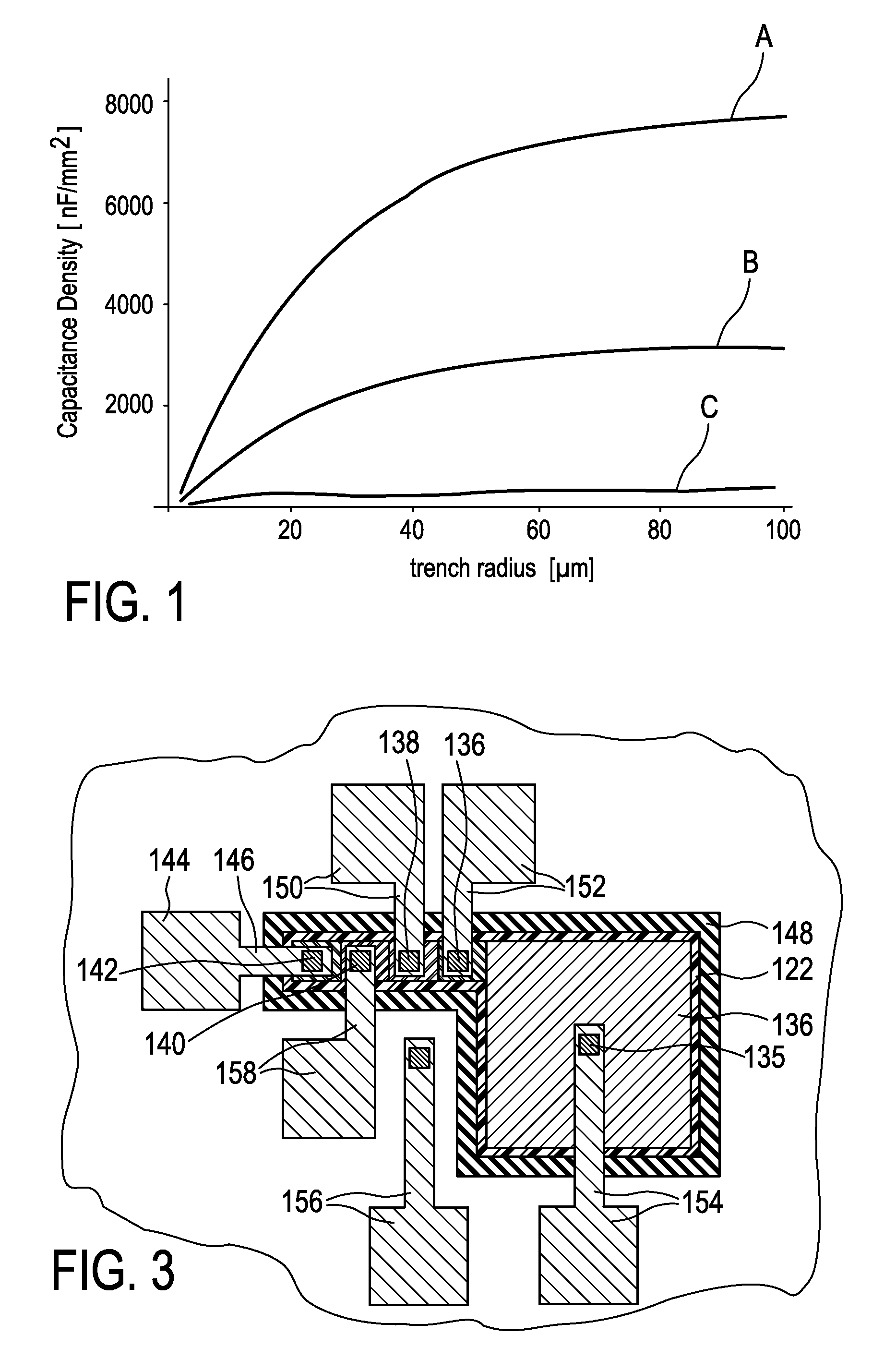

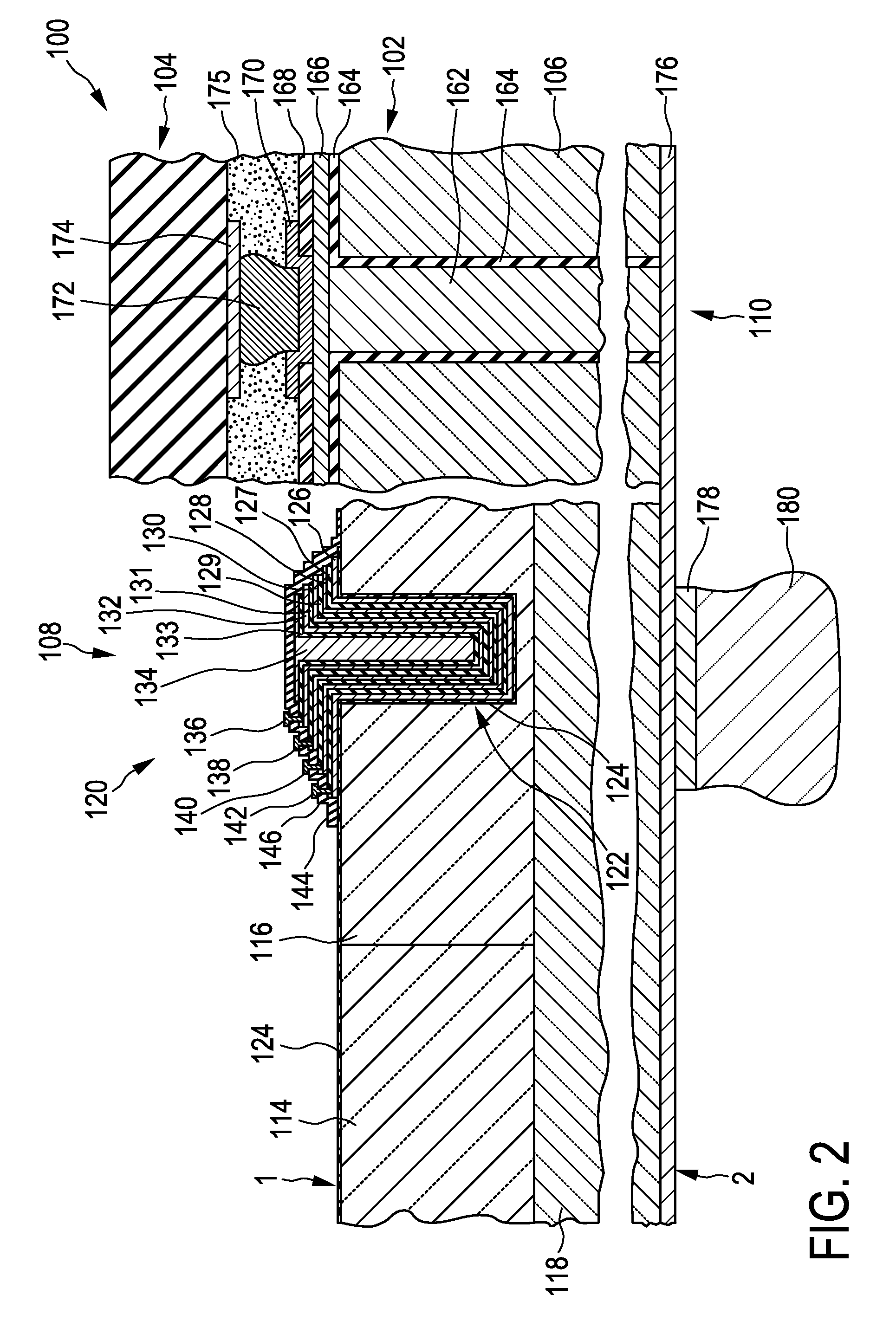

Integration substrate with a ultra-high-density capacitor and a through-substrate via

ActiveUS20100244189A1Simple to introduce into existing production lineIncrease capacitance densitySemiconductor/solid-state device detailsSolid-state devicesMicrometerEngineering

An integration substrate for a system in package comprises a through-substrate via and a trench capacitor wherein with a trench filling that includes at least four electrically conductive capacitor-electrode layers in an alternating arrangement with dielectric layers. —The capacitor-electrode layers are alternatingly connected to a respective one of two capacitor terminals provided on the first or second substrate side. The trench capacitor and the through-substrate via are formed in respective trench openings and via openings in the semiconductor substrate, which have an equal lateral extension exceeding 10 micrometer. This structure allows, among other advantages, a particularly cost-effective fabrication of the integration substrate because the via openings and the trench openings in the substrate can be fabricated simultaneously.

Owner:MURATA INTEGRATED PASSIVE SOLUTIONS

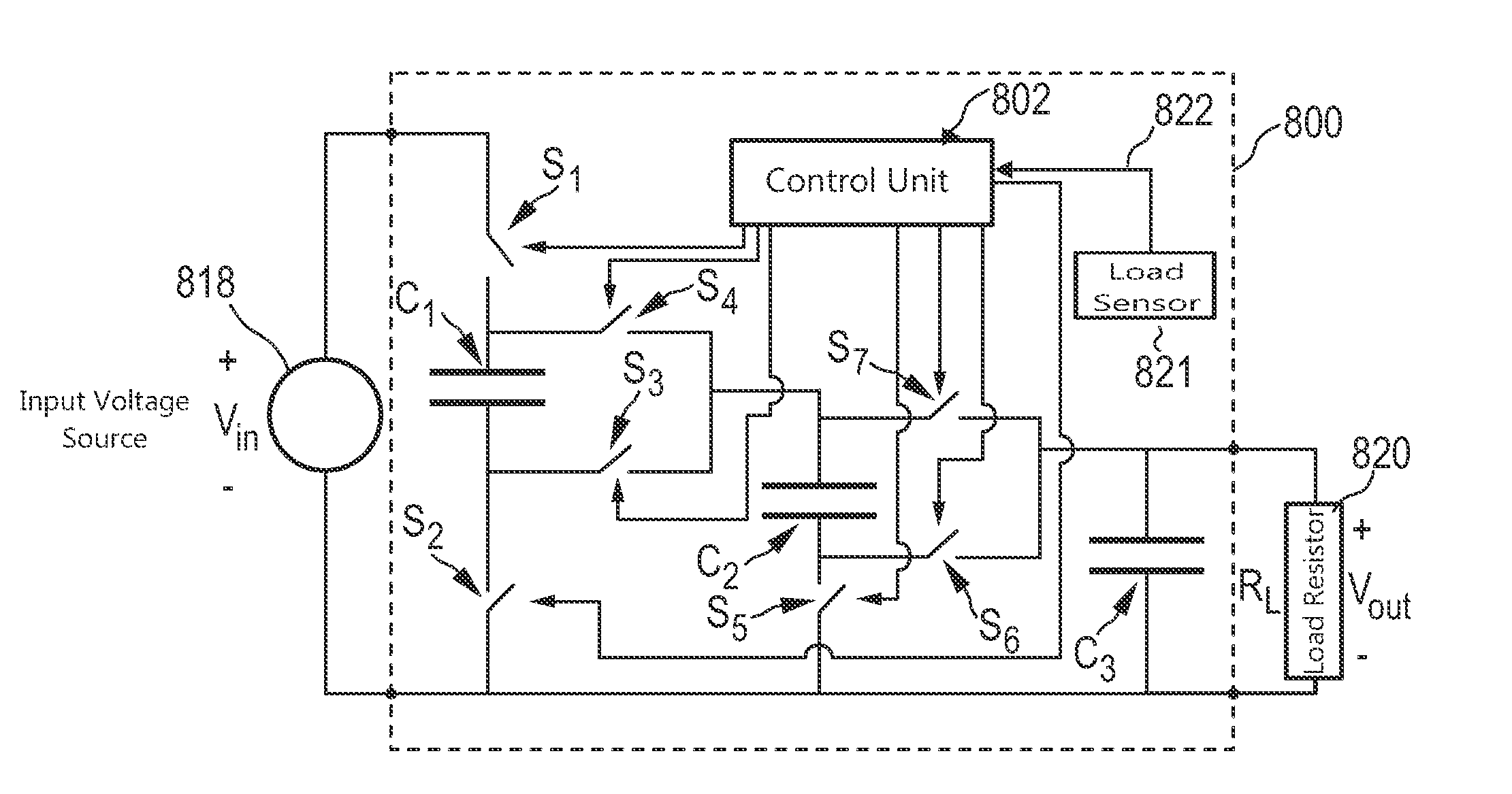

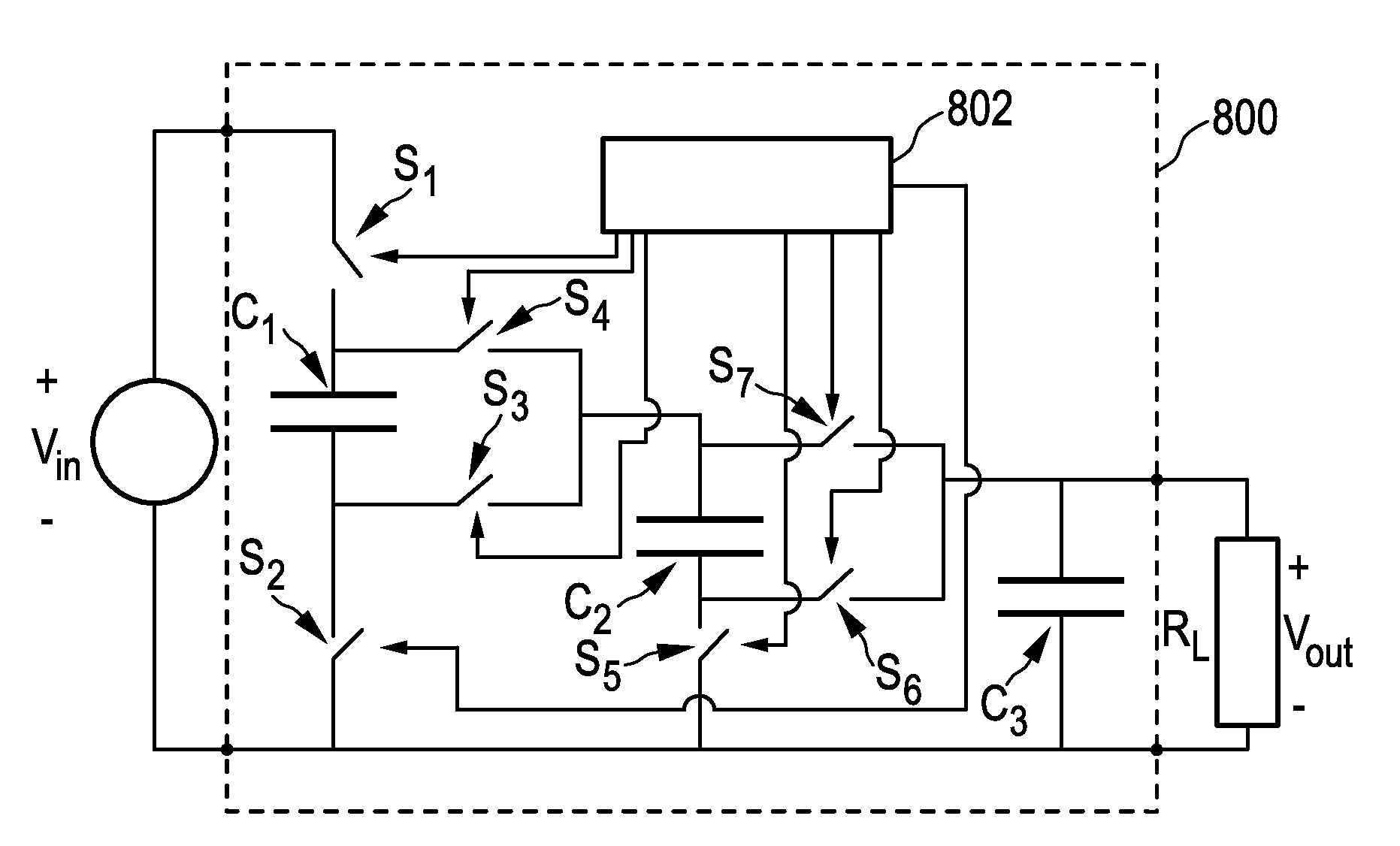

DC-to-DC converter comprising a reconfigurable capacitor unit

ActiveUS8395914B2Reduce lossesCost-effectiveAc-dc conversionSolid-state devicesCapacitanceElectricity

Owner:NXP BV

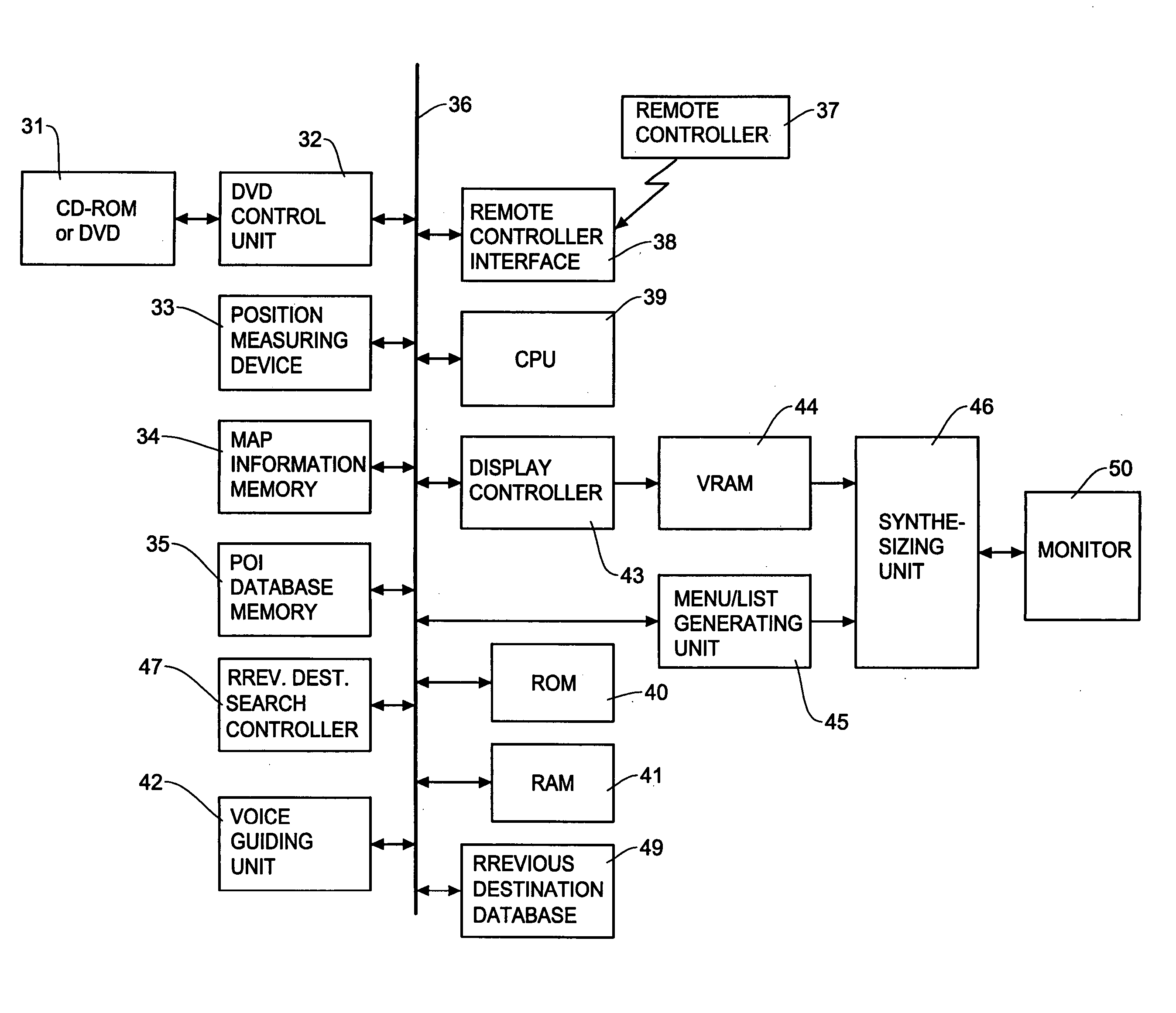

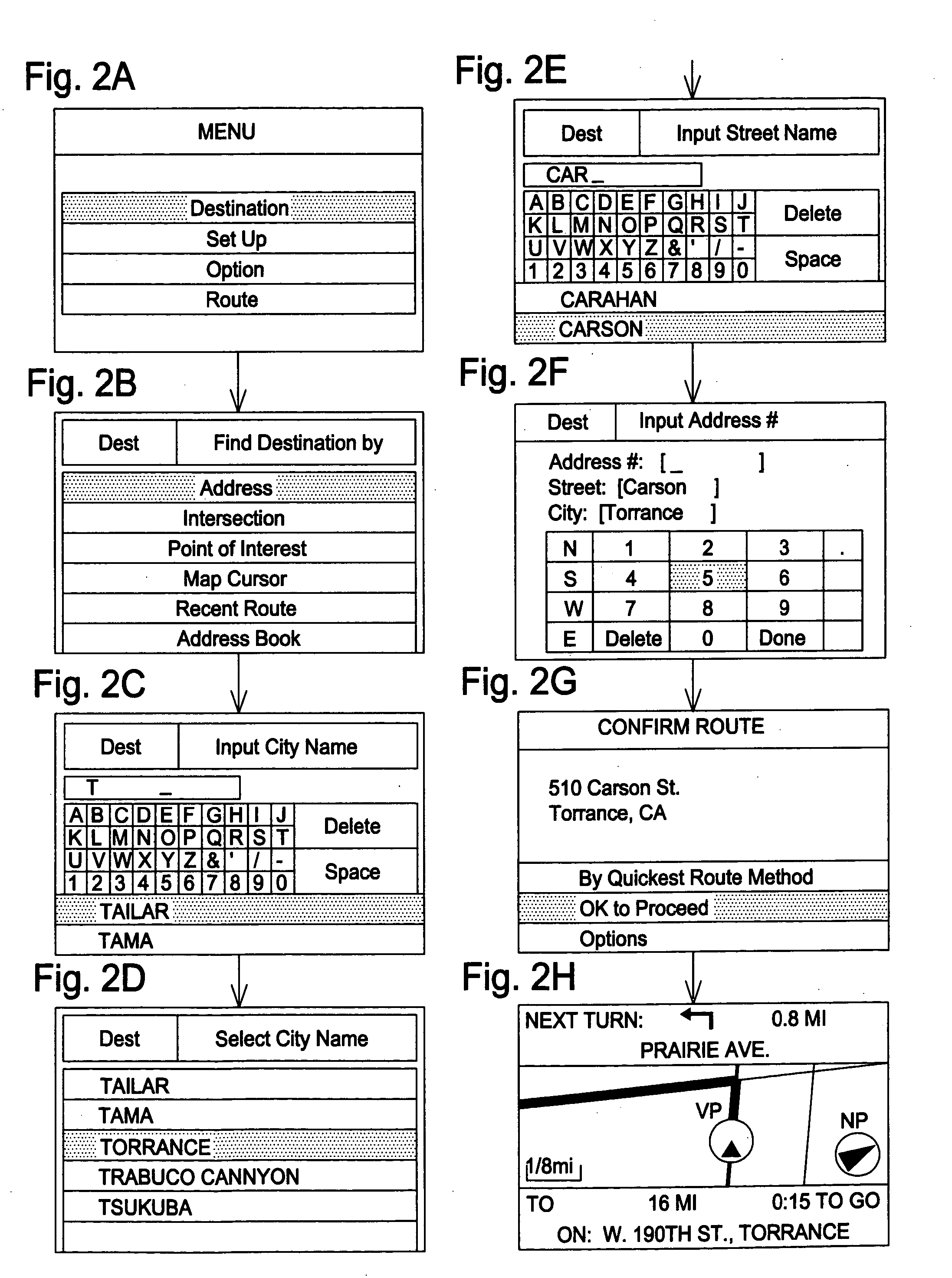

Method and apparatus for specifying destination using previous destinations stored in navigation system

InactiveUS20060015246A1Easily and efficiently alterShorten the timeInstruments for road network navigationRoad vehicles traffic controlNavigation systemComputer science

A method enables a user to quickly and easily specify a destination by selecting and modifying previous destinations stored in the navigation system. The method includes the steps of: creating a previous destination database by storing address information every time when a destination is set in a navigation system, selecting an input method which utilizes the address information in the previous destination database for specifying a new destination, displaying a list of previous destinations set in the previous destination database, selecting one of the destinations from the previous destination list; and selecting a part of address information of the selected destination and changing the selected part to create the new destination.

Owner:ALPINE ELECTRONICS INC

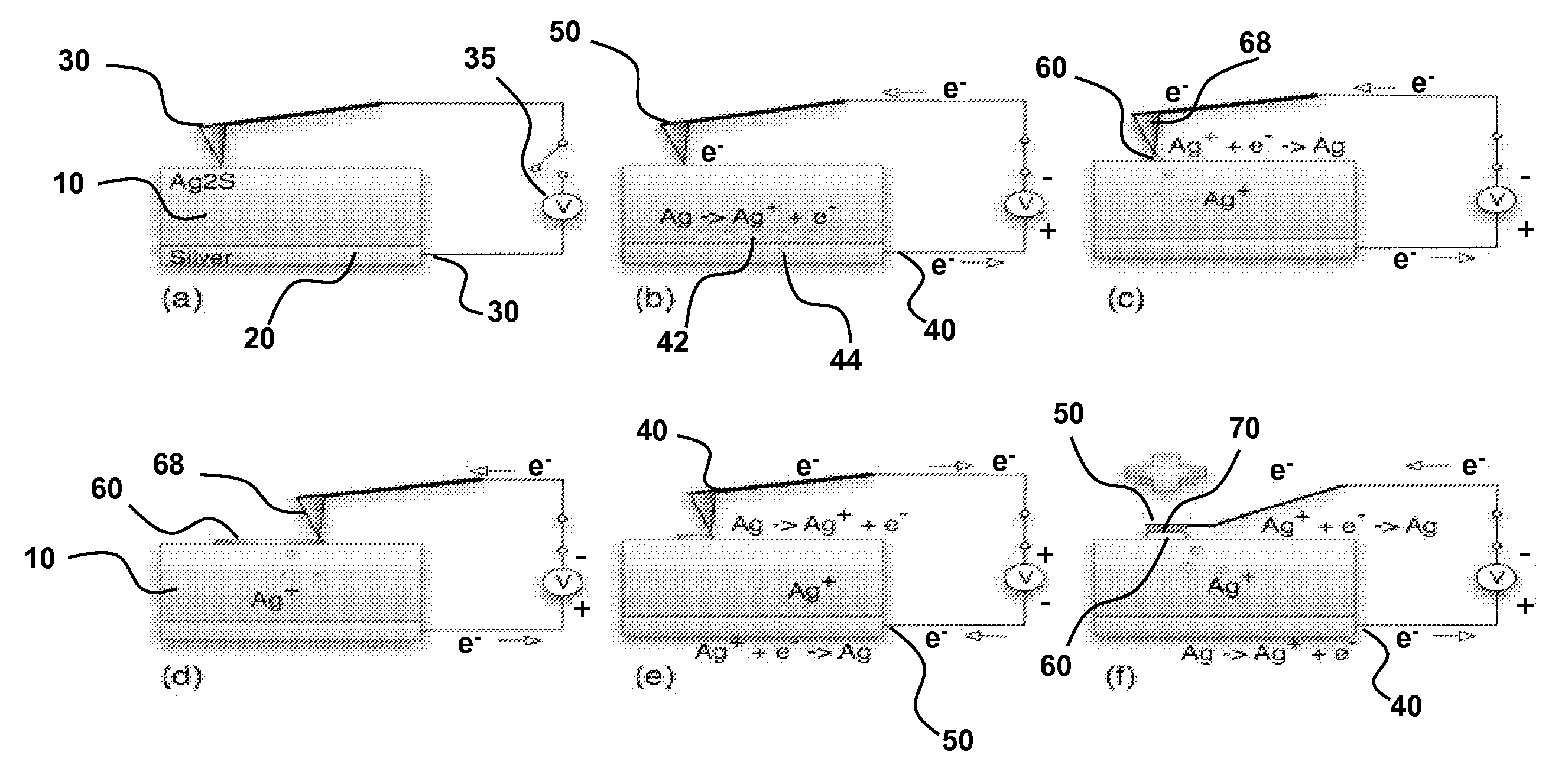

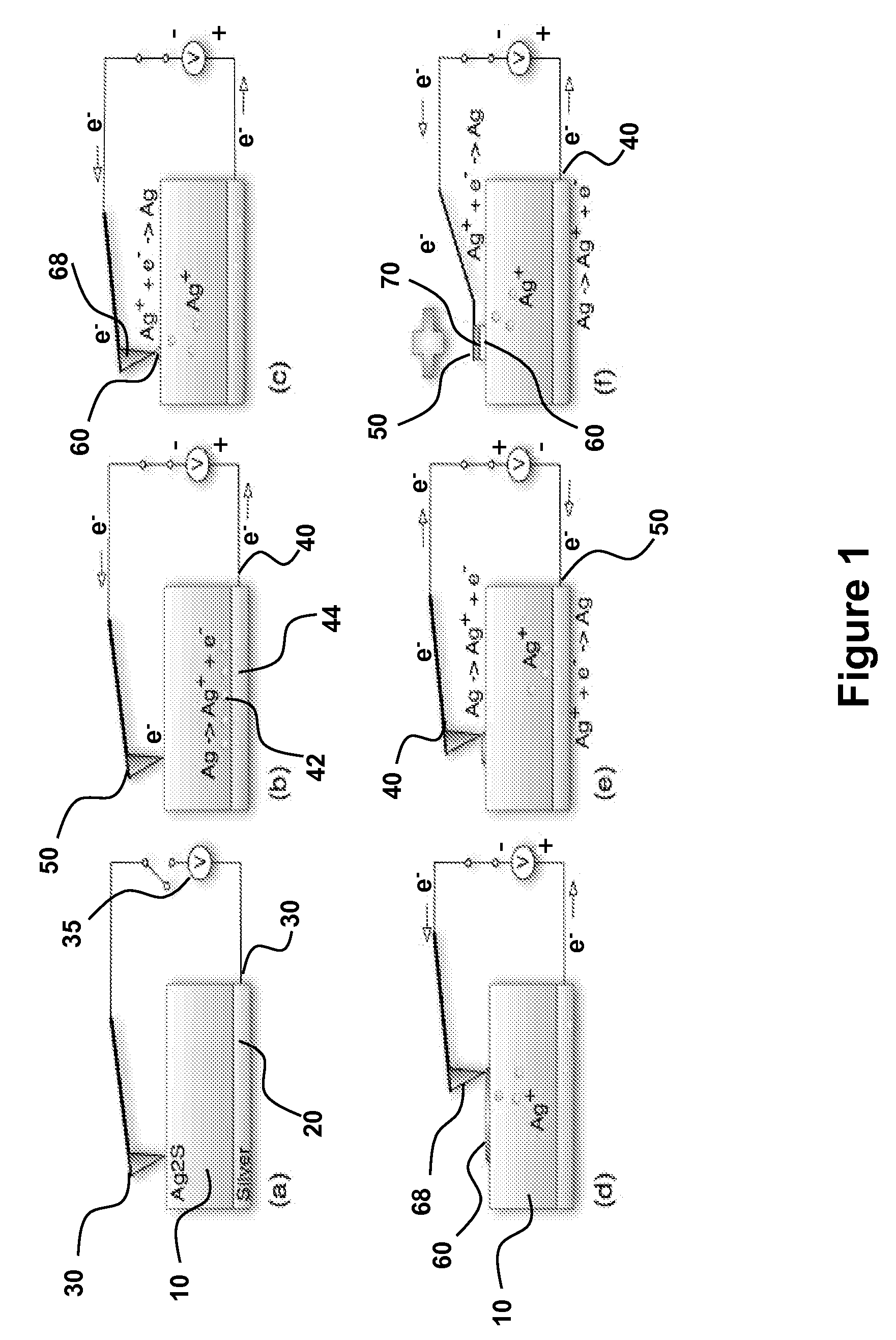

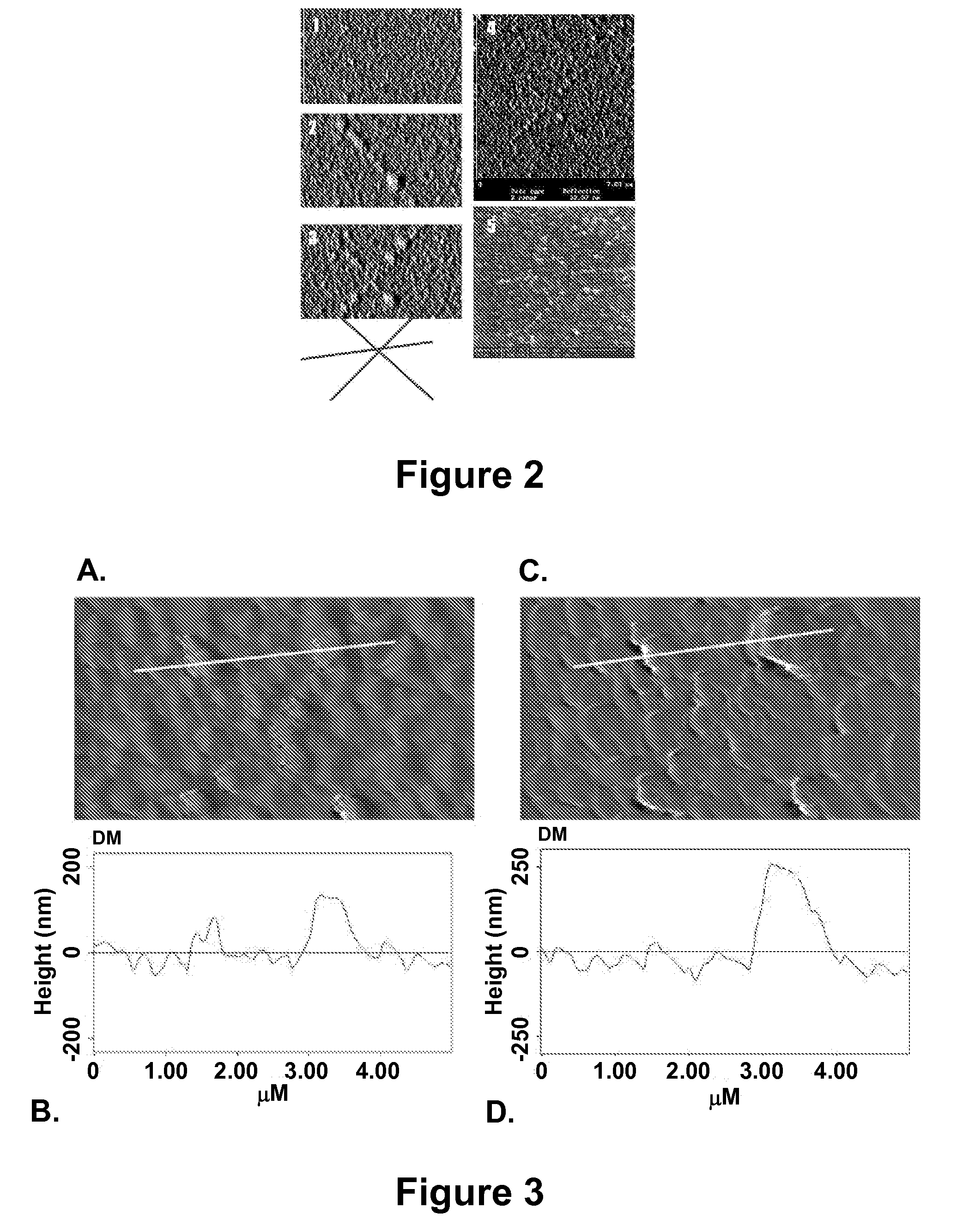

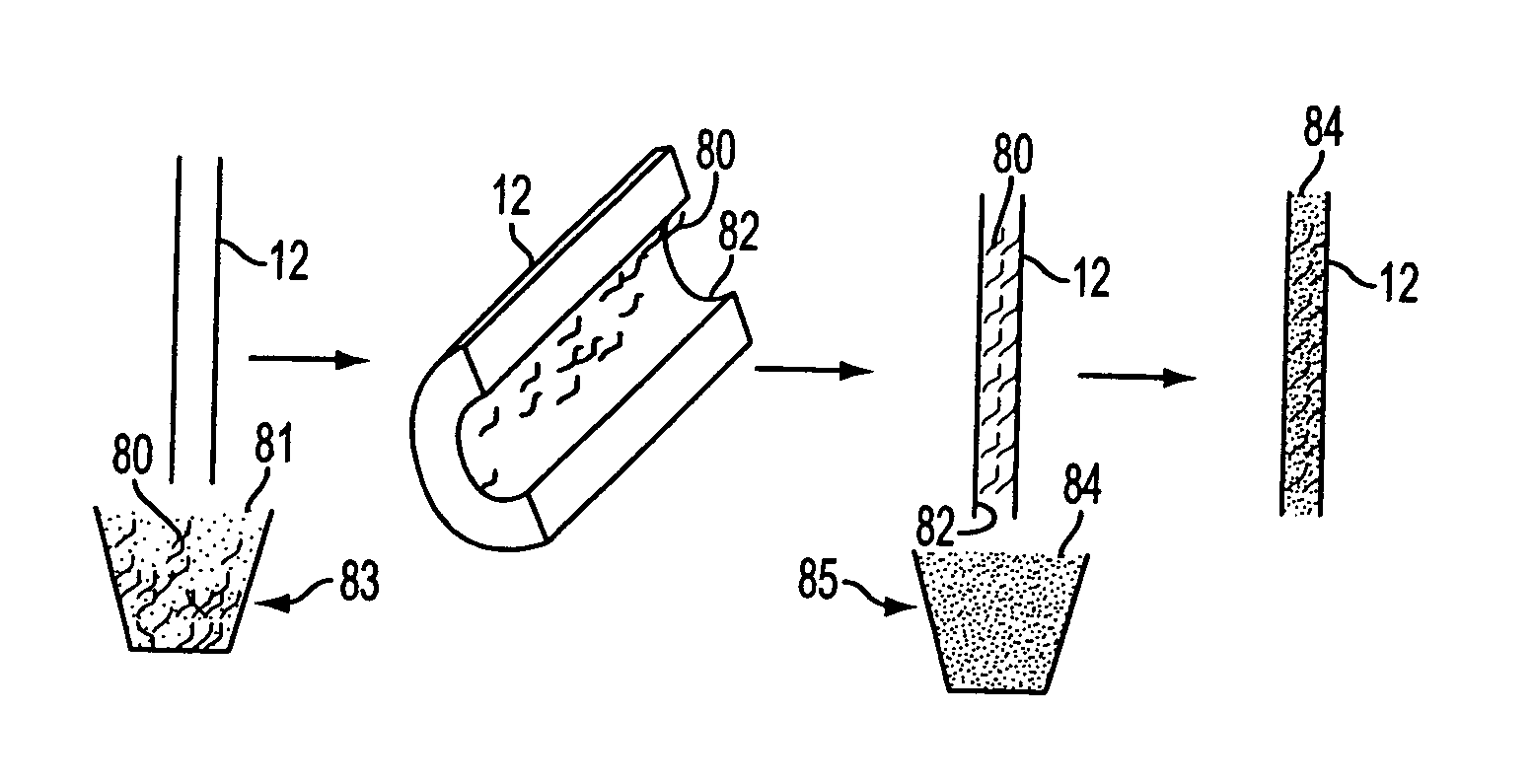

Direct Nanoscale Patterning of Metals Using Polymer Electrolytes

InactiveUS20090050487A1Improve throughputRobust and commercially attractive manufacturing pathwayMachining electrodesMaterial nanotechnologySpatial OrientationsElectrical conductor

Disclosed herein are electrochemical fabrication platforms for making structures, arrays of structures and functional devices having selected nanosized and / or microsized physical dimensions, shapes and spatial orientations. Methods, systems and system components use an electrochemical stamping tool such as solid state polymeric electrolytes for generating patterns of relief and / or recessed features exhibiting excellent reproducibility, pattern fidelity and resolution on surfaces of solid state ionic conductors and in metal. Electrochemical stamping tools are capable high throughput patterning of large substrate areas, are compatible with commercially attractive manufacturing pathways to access a range of functional systems and devices including nano- and micro-electromechanical systems, sensors, energy storage devices, metal masks for printing, interconnects, and integrated electronic circuits.

Owner:THE BOARD OF TRUSTEES OF THE UNIV OF ILLINOIS

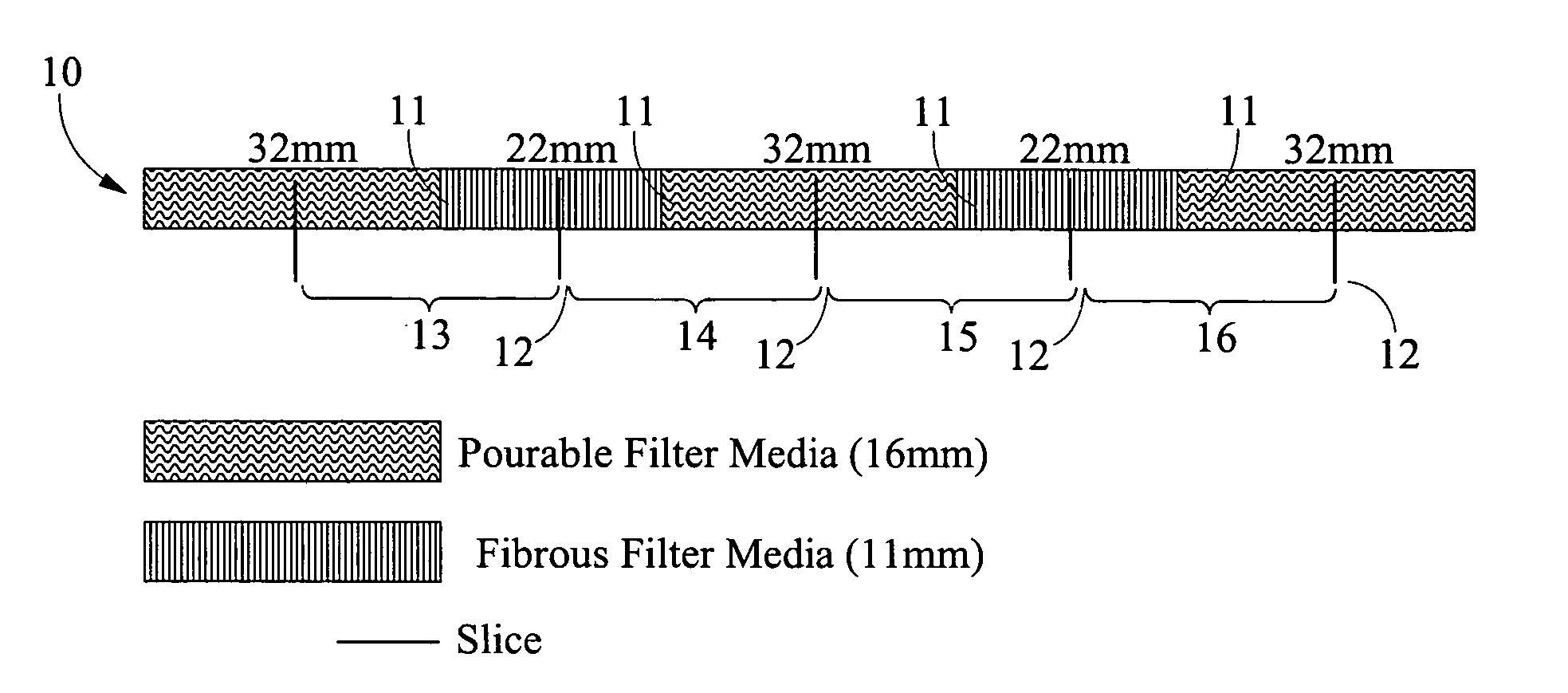

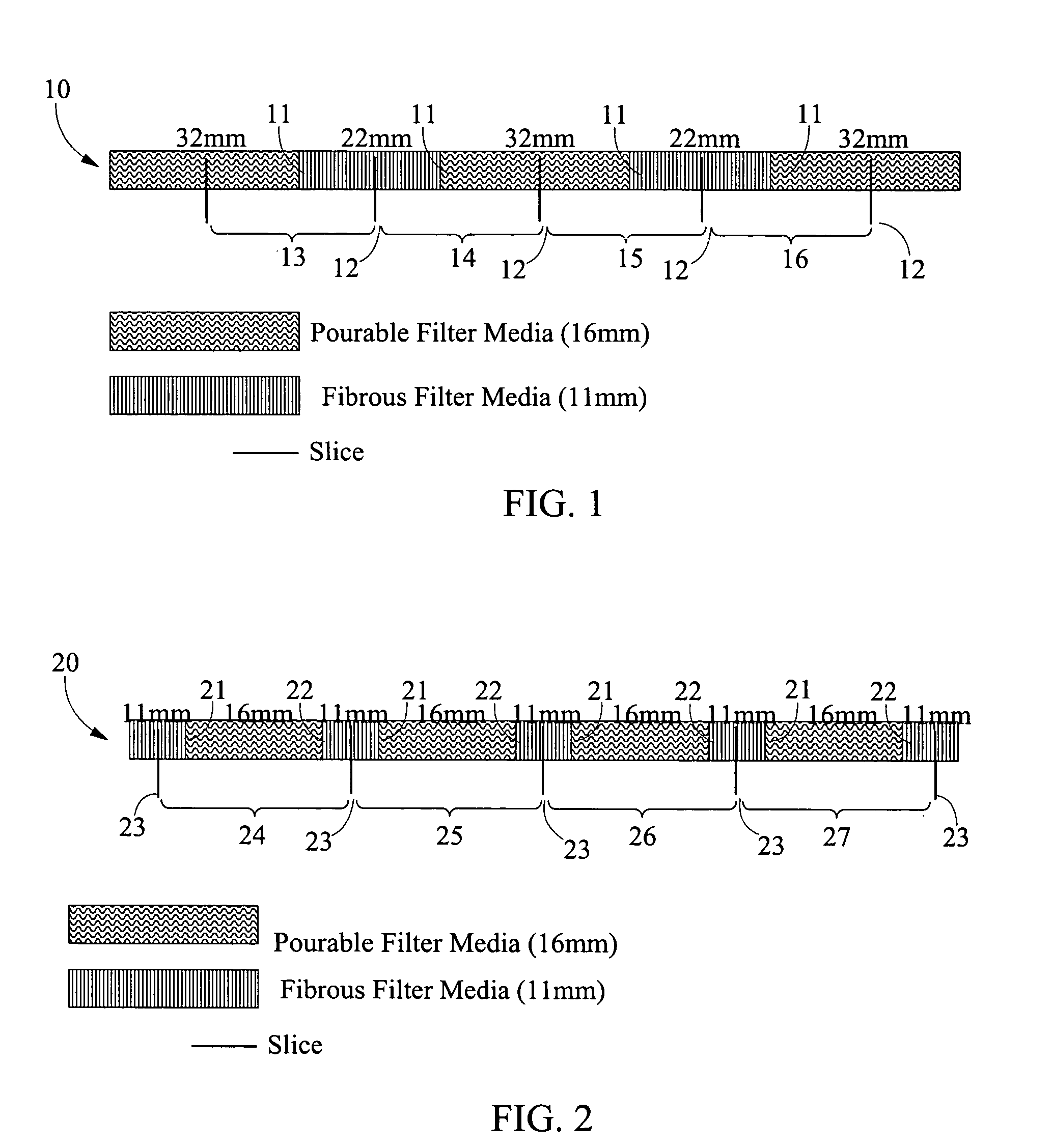

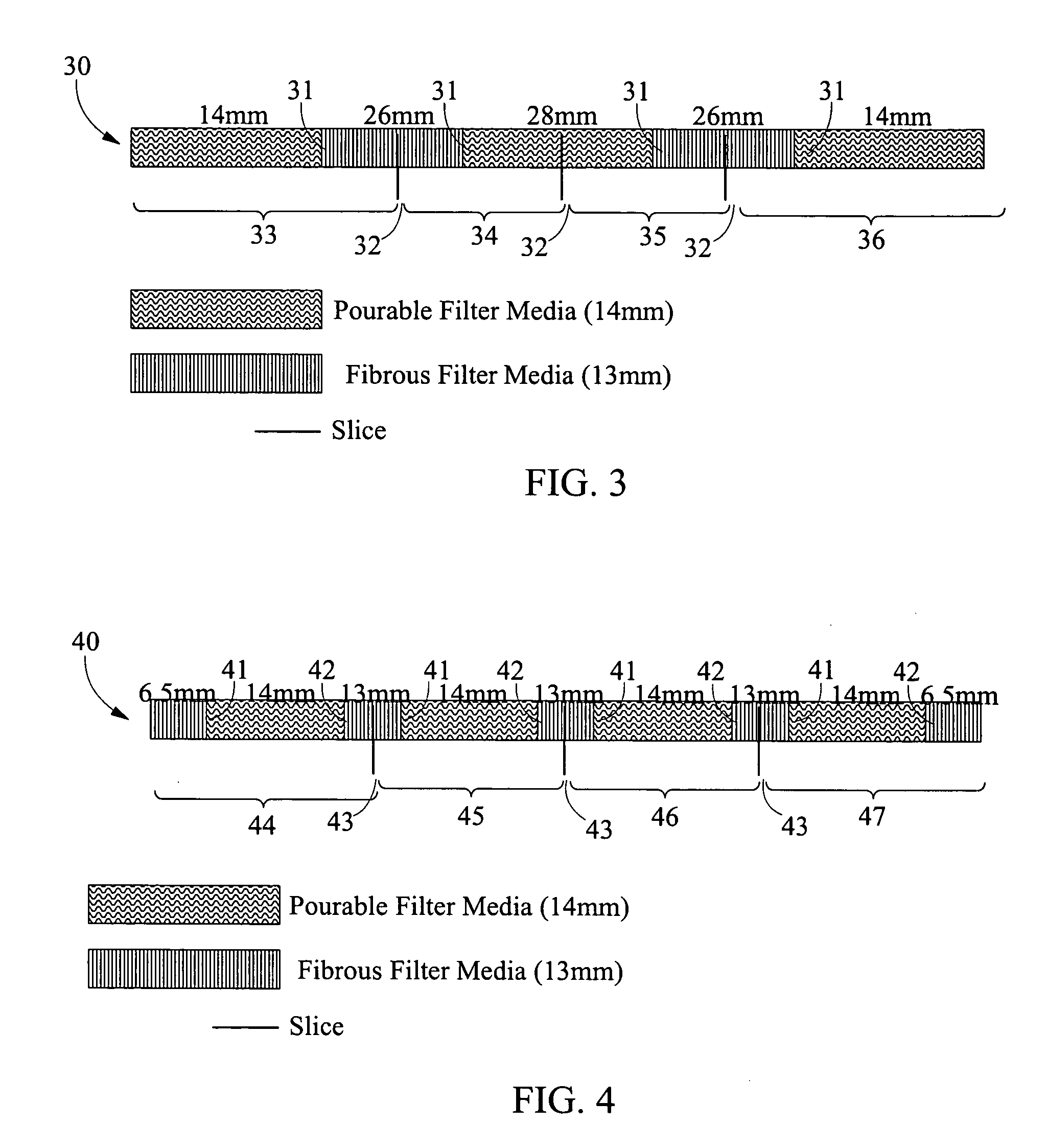

Producing triple section filters using a dual rod filter maker

InactiveUS20060025292A1Reduce switching costsSave stepsPaper/cardboard wound articlesTobacco smoke filtersEngineeringFour component

A method of producing a multi-component cigarette filter having one more filter component than the number of hoppers on the machine producing the cigarette filter rods. A dual hopper machine can produce two-component filters as well as three-component filters, and a three hopper machine can produce three-component filters as well as four-component filters.

Owner:BROWN & WILLIAMSON TOBACCO

Dc-to-dc converter comprising a reconfigurable capacitor unit

ActiveUS20100117612A1Minimizing output impedanceReduce switching lossesAc-dc conversionSolid-state devicesCapacitanceControl signal

The present invention relates to a configurable trench multi-capacitor device comprising a trench in a semiconductor substrate. The trench has a lateral extension exceeding 10 micrometer and a trench filling includes a number of at least four electrically conductive capacitor-electrode layers. A switching unit is provided that comprises a plurality of switching elements electrically interconnected between different capacitor-electrode layers of the trench filling. A control unit is connected with the switching unit and configured to generate and provide to the switching unit respective control signals for forming a respective one of a plurality of multi-capacitor configurations using the capacitor-electrode layers of the trench filling.

Owner:NXP BV

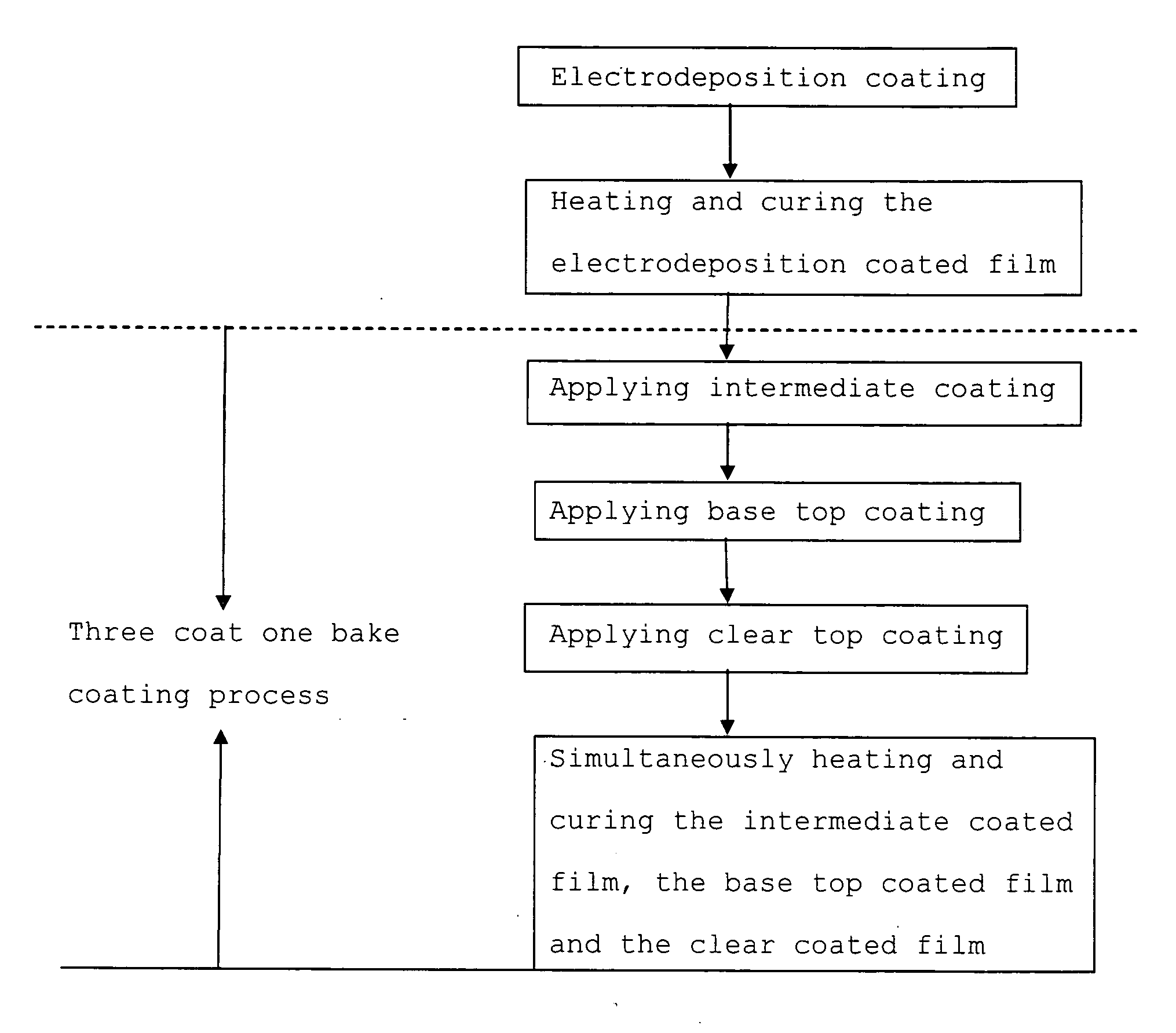

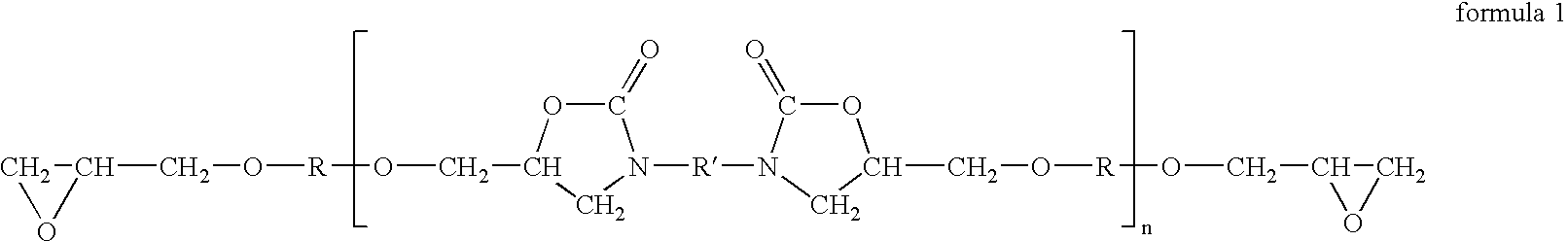

Process for forming multi layered coated film and multi layered coated film

InactiveUS20050161330A1Save energyLow costElectrolysis componentsVolume/mass flow measurementVolumetric Mass DensityCoating

The present invention provides a process for forming a multi layered coated film having good finished appearance. The present invention relates to a process for forming a multi layered coated film comprising the steps of conducting electrodeposition coating with a cationic electrodeposition coating composition on a substrate, and then heating and curing it to form an cured electrodeposition coated film on the substrate, applying an intermediate coating composition on the cured coated film to form an uncured intermediate coated film, applying a base top coating composition on the uncured intermediate coated film to form an uncured base coated film, applying a clear top coating composition on the uncured base coated film to form an uncured clear coated film, and simultaneously heating and curing the three uncured coated films, wherein the cured electrodeposition coated film has specified ranges of Ra and Pa; or has specified ranges of Tg and crosslinking density.

Owner:NIPPON PAINT CO LTD

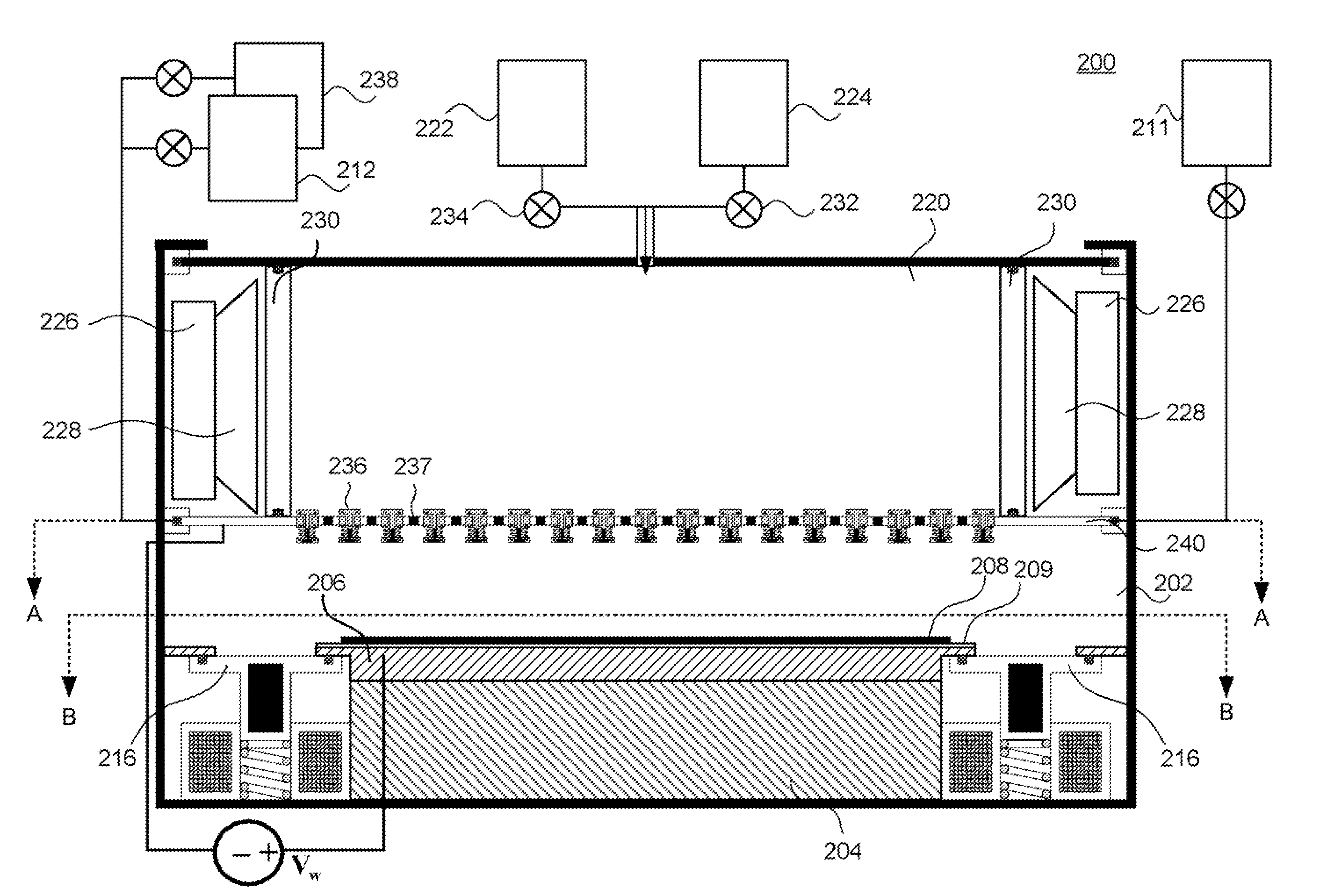

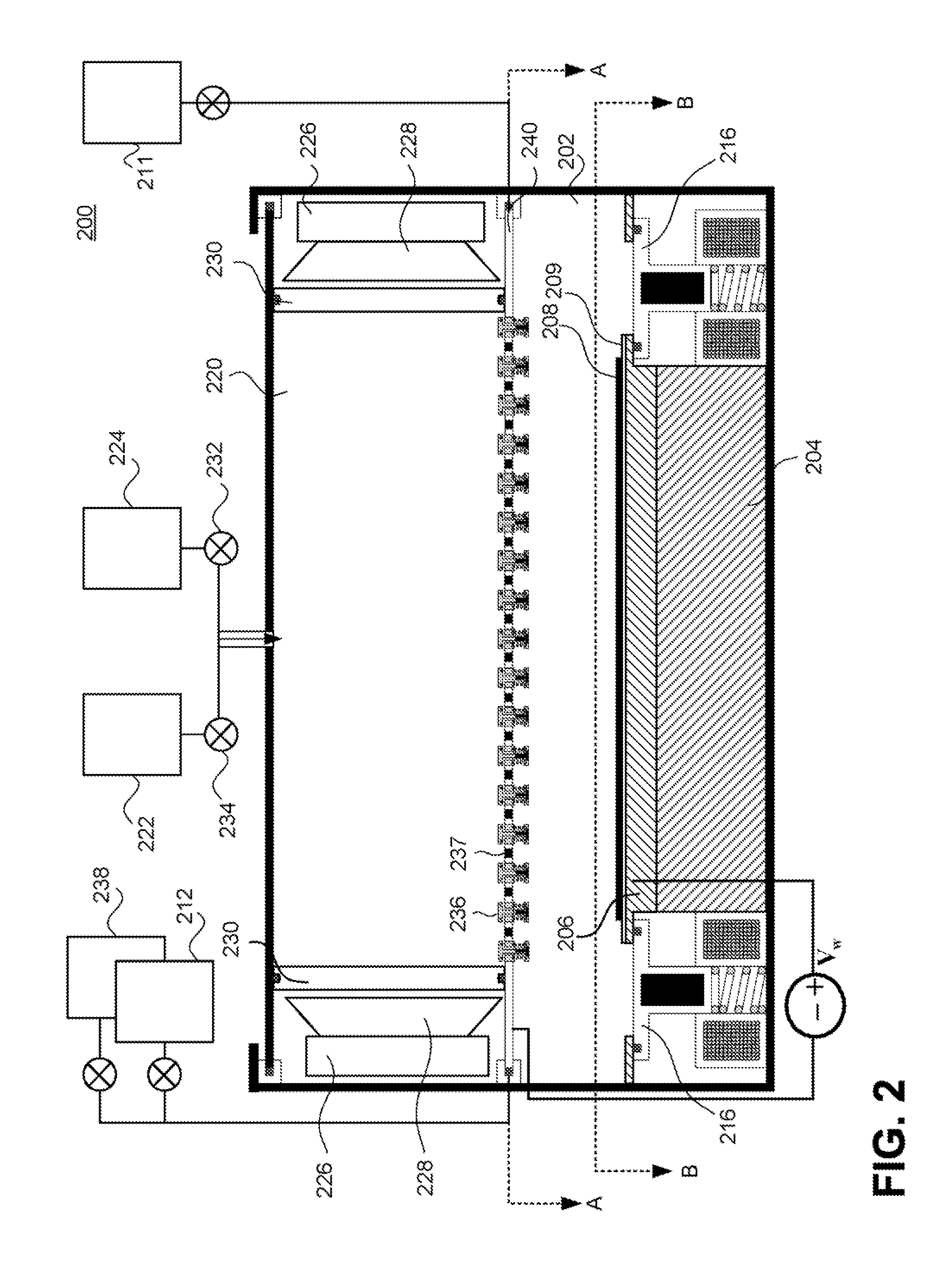

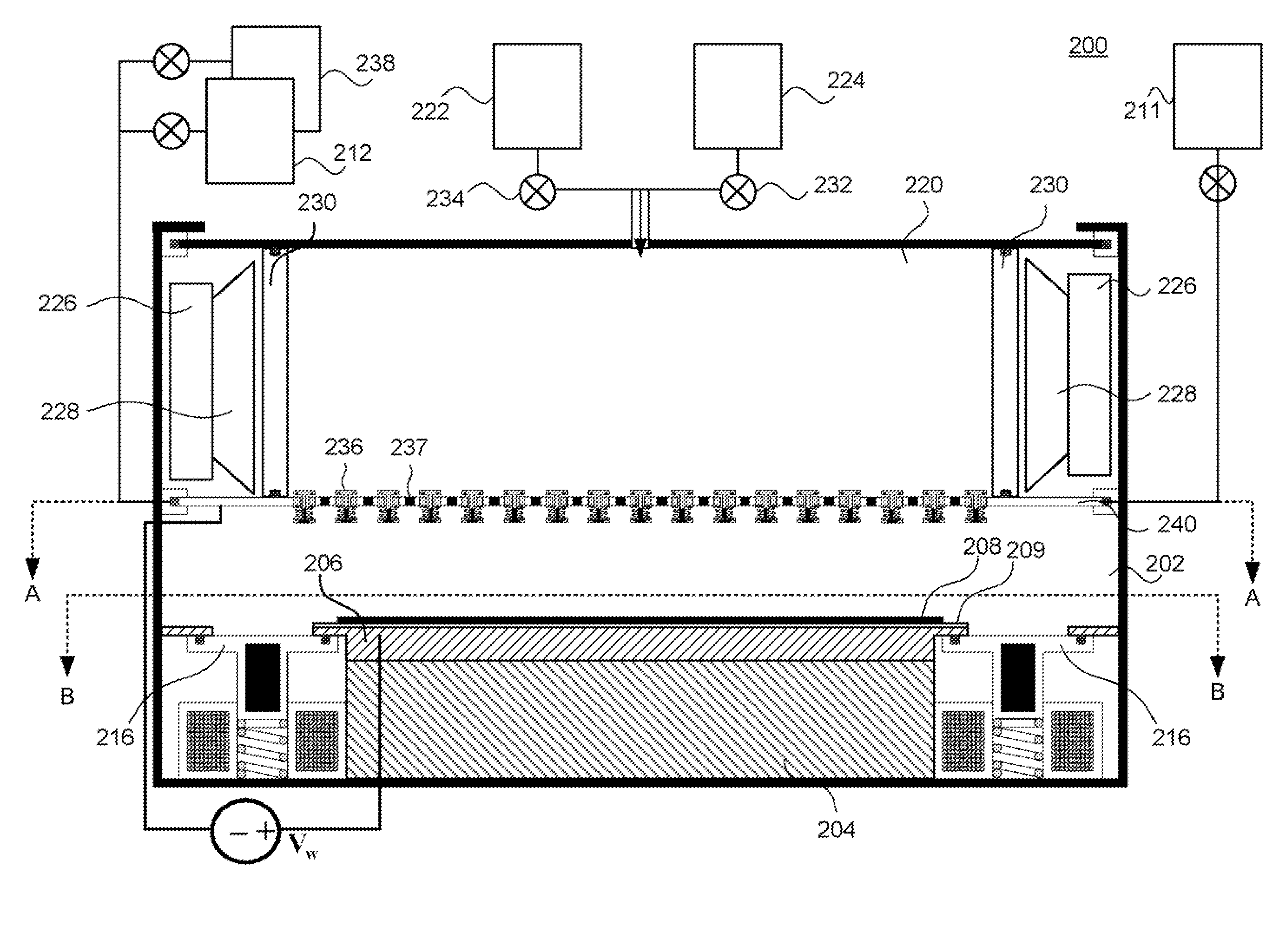

Systems for Flash Heating in Atomic Layer Deposition

InactiveUS20100024732A1Reduce incorporationQuality improvementElectric discharge tubesSemiconductor/solid-state device manufacturingMetallurgyAtomic layer deposition

System and methods for flash heating of materials deposited using atomic layer deposition techniques are disclosed. By flash heating the surface of the deposited material after each or every few deposition cycles, contaminants such as un-reacted precursors and byproducts can be released from the deposited material. A higher quality material is deposited by reducing the incorporation of impurities. A flash heating source is capable of quickly raising the temperature of the surface of a deposited material without substantially raising the temperature of the bulk of the substrate on which the material is being deposited. Because the temperature of the bulk of the substrate is not significantly raised, the bulk acts like a heat sink to aid in cooling the surface after flash heating. In this manner, processing times are not significantly increased in order to allow the surface temperature to reach a suitably low temperature for deposition.

Owner:SANDISK TECH LLC

Thin-film transistor array substrate

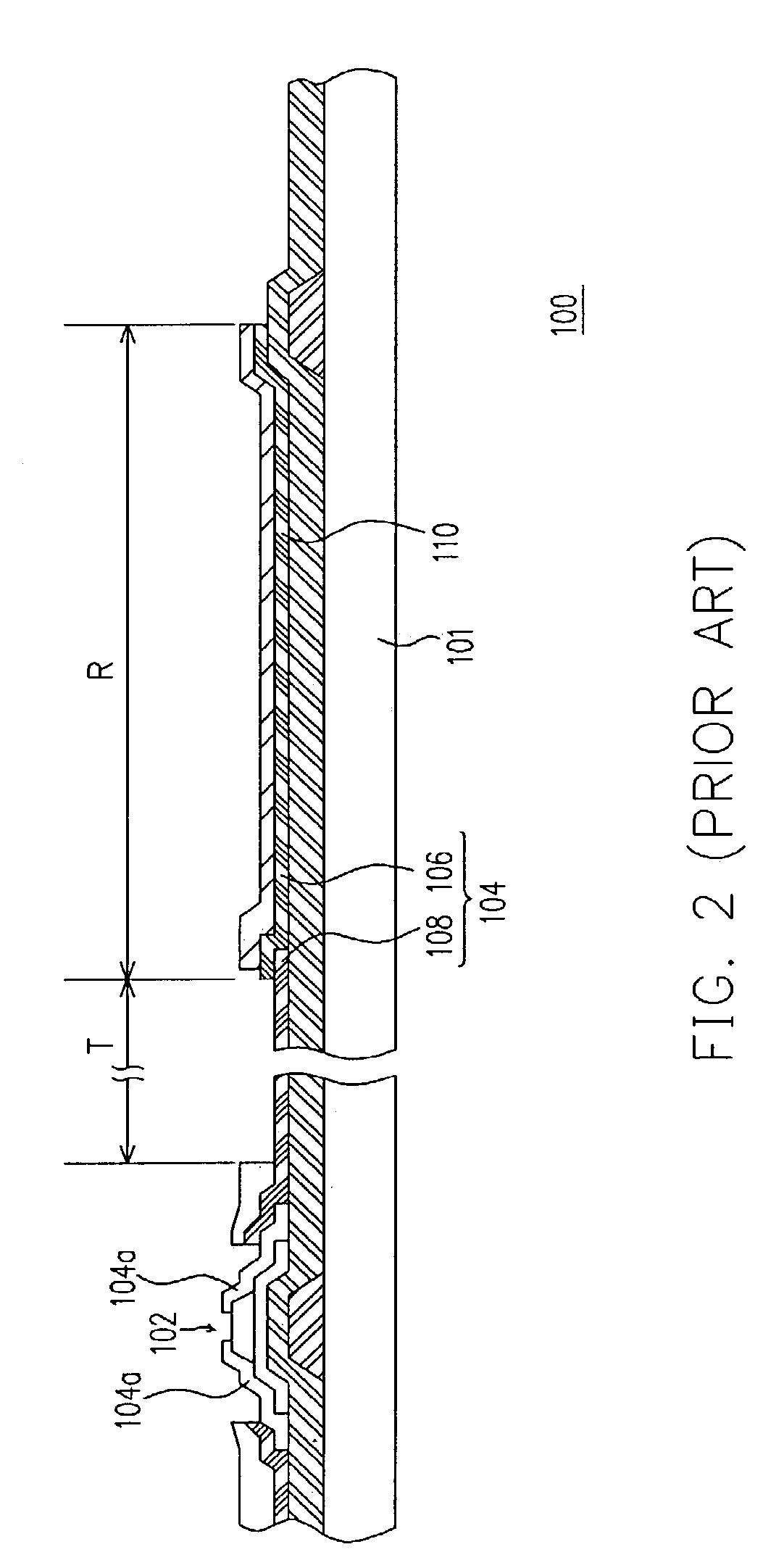

InactiveUS7084942B2Reduce manufacturing costSave stepsNon-linear opticsLiquid-crystal displayScan line

A thin-film transistor array substrate, used in a transflective liquid crystal display. The thin-film transistor array substrate has a substrate, a plurality of pixels, a plurality of scan lines and a plurality of data lines. Each of the pixels has a transparent sub-pixel and a reflective sub-pixel, while the transparent sub-pixel further has a transparent electrode and a first thin-film transistor, and the reflective sub-pixel has a reflective pixel electrode and a second thin-film transistor. The pixel electrode of each sub-pixel is thus electrically connected to a different thin-film transistor. The step of forming a molybdenum layer is thus not required, saving fabrication cost.

Owner:AU OPTRONICS CORP

Titanium alkoxide catalysts for polymerization of cyclic esters and methods of polymerization

InactiveUS20050009687A1Save stepsLow costCatalyst protectionMolecular sieve catalystsPolyesterWeight distribution

Titanium alkoxide catalysts for polymerization of cyclic esters such as LA and CL and methods of polymerization are disclosed. Titanium is known to be non-toxic and the various compounds described herein can catalyze cyclic esters to produce polyesters with controlled molecular weights and relatively narrow molecular weight distributions. In one embodiment, caged titanium alkoxides catalysts are used. The caged titanium alkoxides can be atranes or non-atranes.

Owner:IOWA STATE UNIV RES FOUND

Two-step MOSFET gate formation for high-density devices

InactiveUS6333247B1Reduces device topographyReduces the demands on backend lithographyTransistorSemiconductor/solid-state device manufacturingMOSFETHigh density

A method of manufacturing a metal-oxide-semiconductor field effect transistor MOSFET device gate includes patterning and etching the mesa of a gate material. A dielectric layer is formed on the mesa and is planarized using chemical mechanical polishing (CMP). The active gate dimension is patterned and etched to form source and drain wells that extend down to an active area on either side of the MOSFET gate. In one further embodiment, the wells are filled with metal and the metal is planarized. The MOSFET device, in one embodiment, includes source and drain wells equally spaced from the active gate.

Owner:IBM CORP

Methods and apparatus for performing submicroliter reactions with nucleic acids or proteins

InactiveUS7138254B2Reduce processing stepsAvoid pollutionHeating or cooling apparatusSugar derivativesHigh-fluence-rate responseSystems design

Methods for preparing nanoscale reactions using nucleic acids or proteins are presented. Nucleic acids are captured saturably, yet reversibly, on the internal surface of the reaction chamber, typically a capillary. Excess nucleic acid is removed and the reaction is performed directly within the capillary. Proteins are captured specifically and saturably on the modified inner surface of the reaction chamber, typically a capillary. Excess protein is removed and the reaction is performed directly within the capillary. Devices for effecting the methods of the invention and a system designed advantageously to utilize the methods for high throughput reactions involving nucleic acids or proteins are also provided.

Owner:INTEGENX

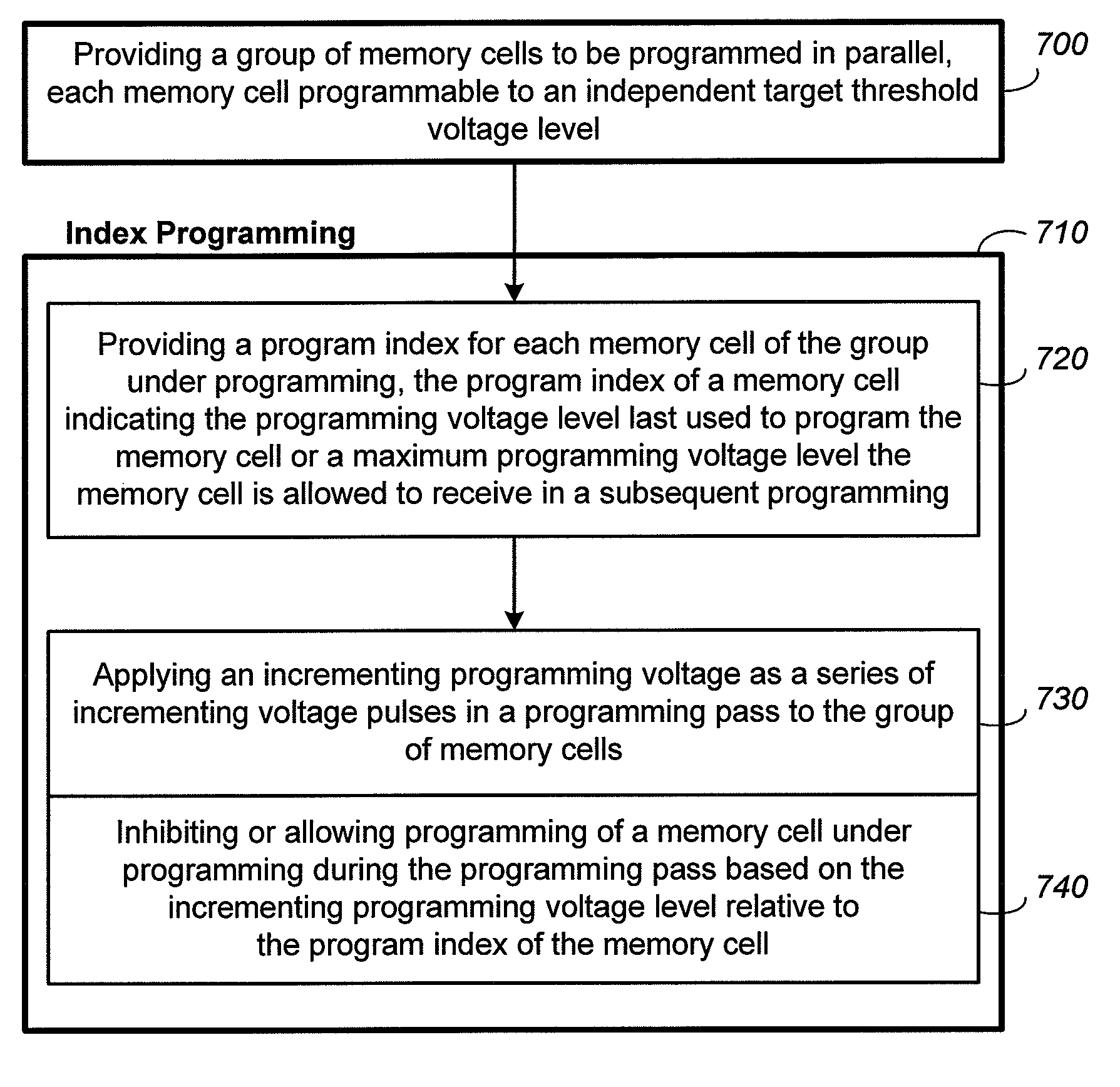

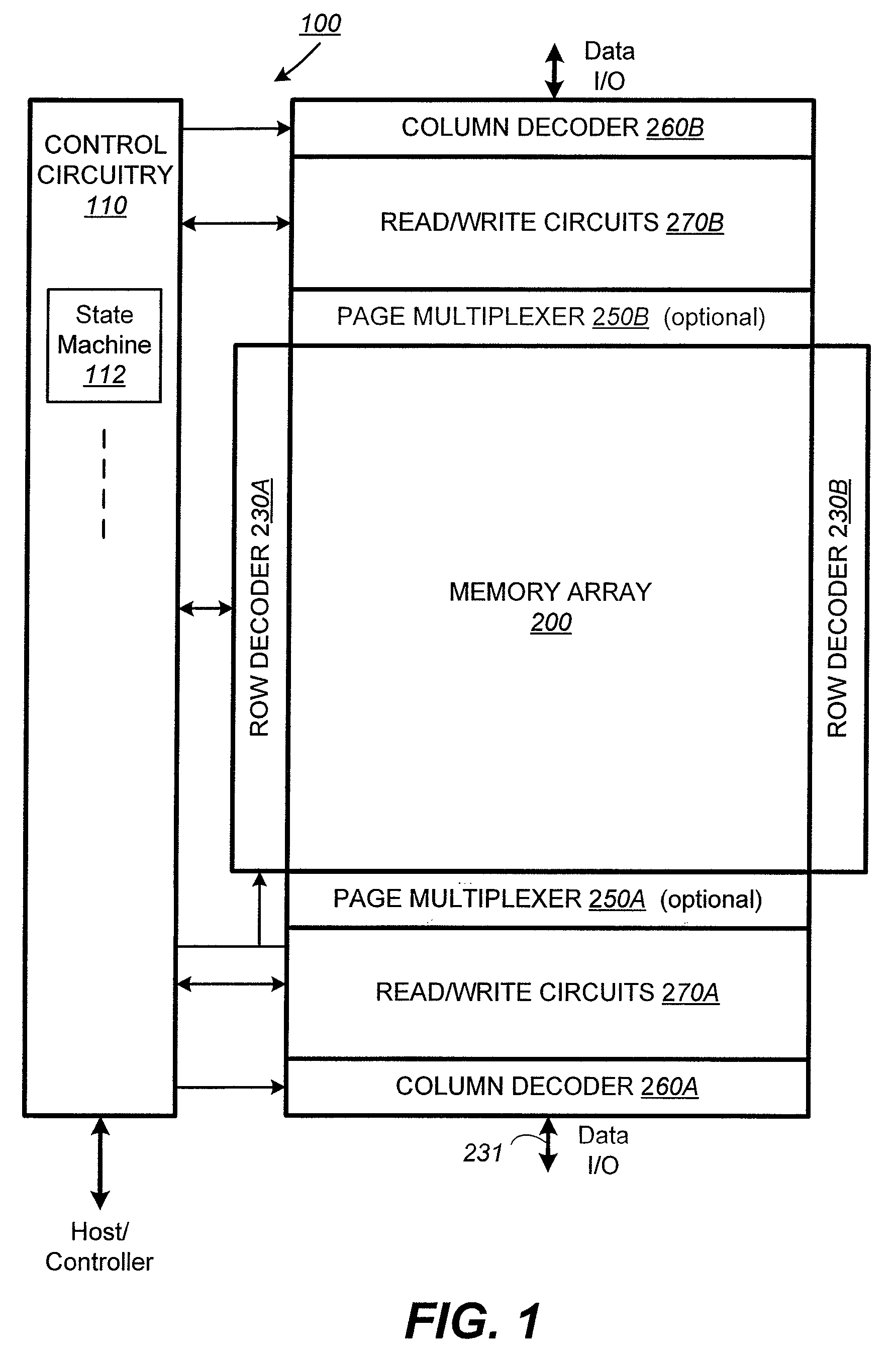

Method for index programming and reduced verify in nonvolatile memory

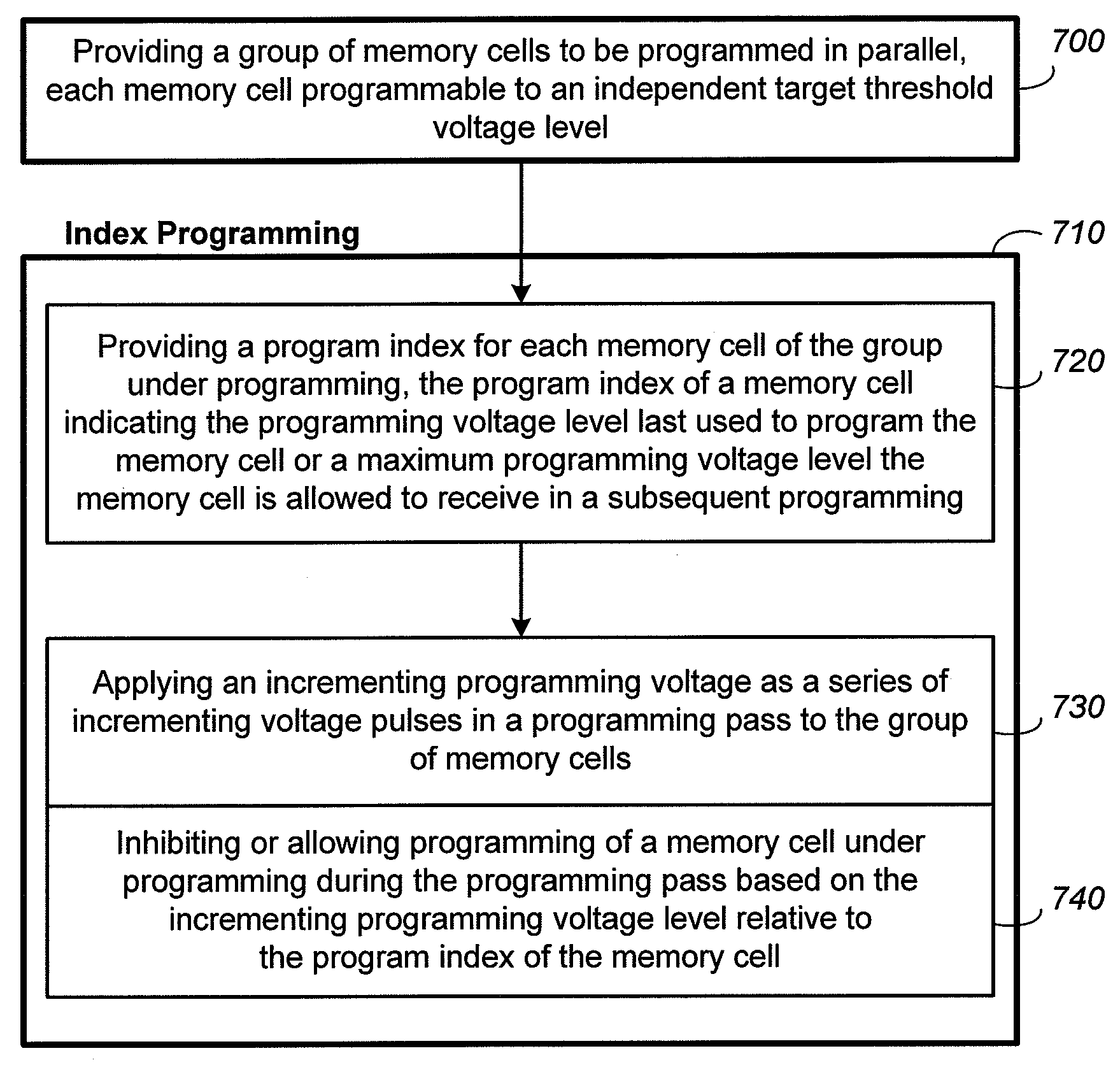

ActiveUS7800945B2Save stepsTighten distributionRead-only memoriesDigital storageInductive programmingMultiple pass

Owner:SANDISK TECH LLC

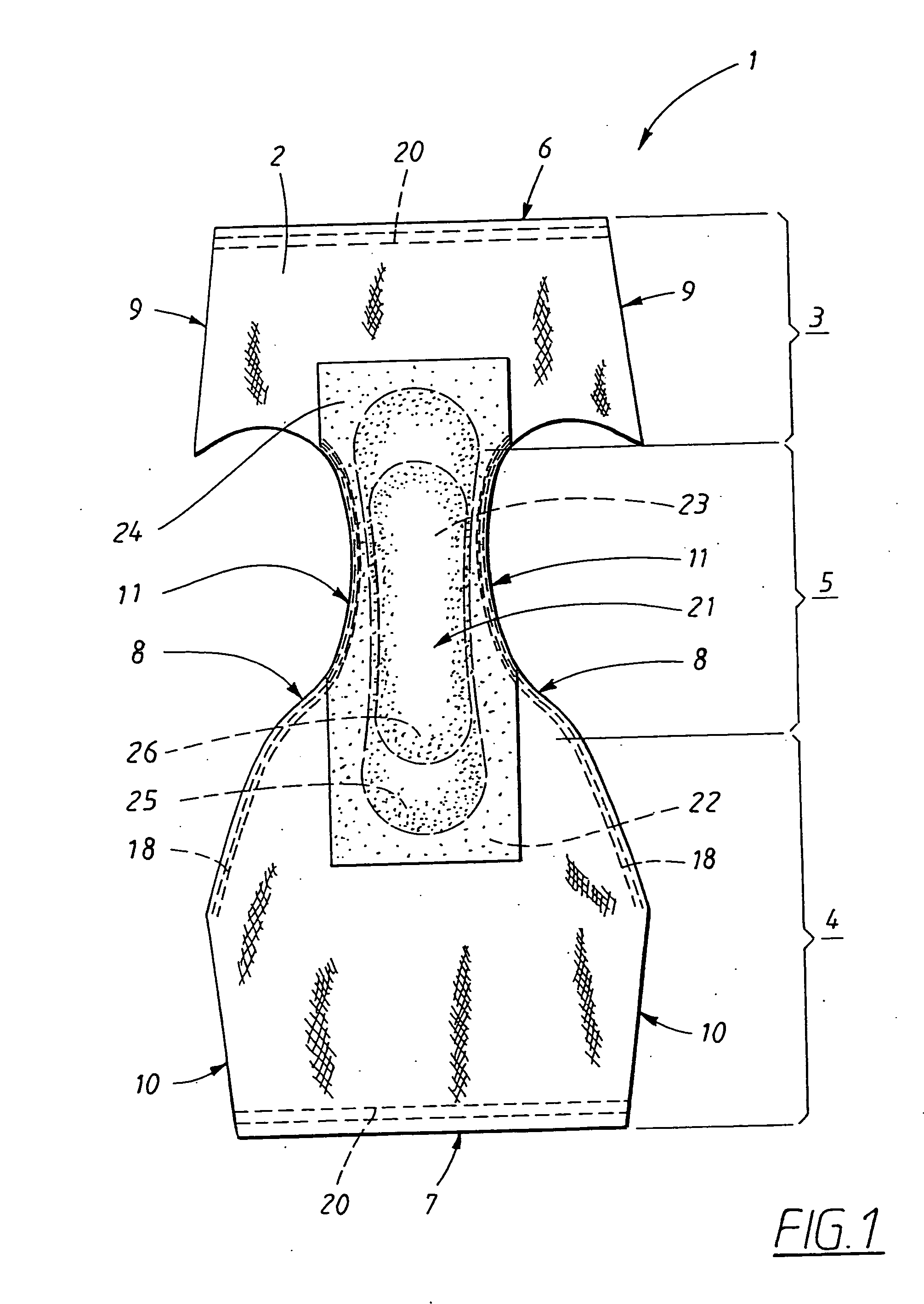

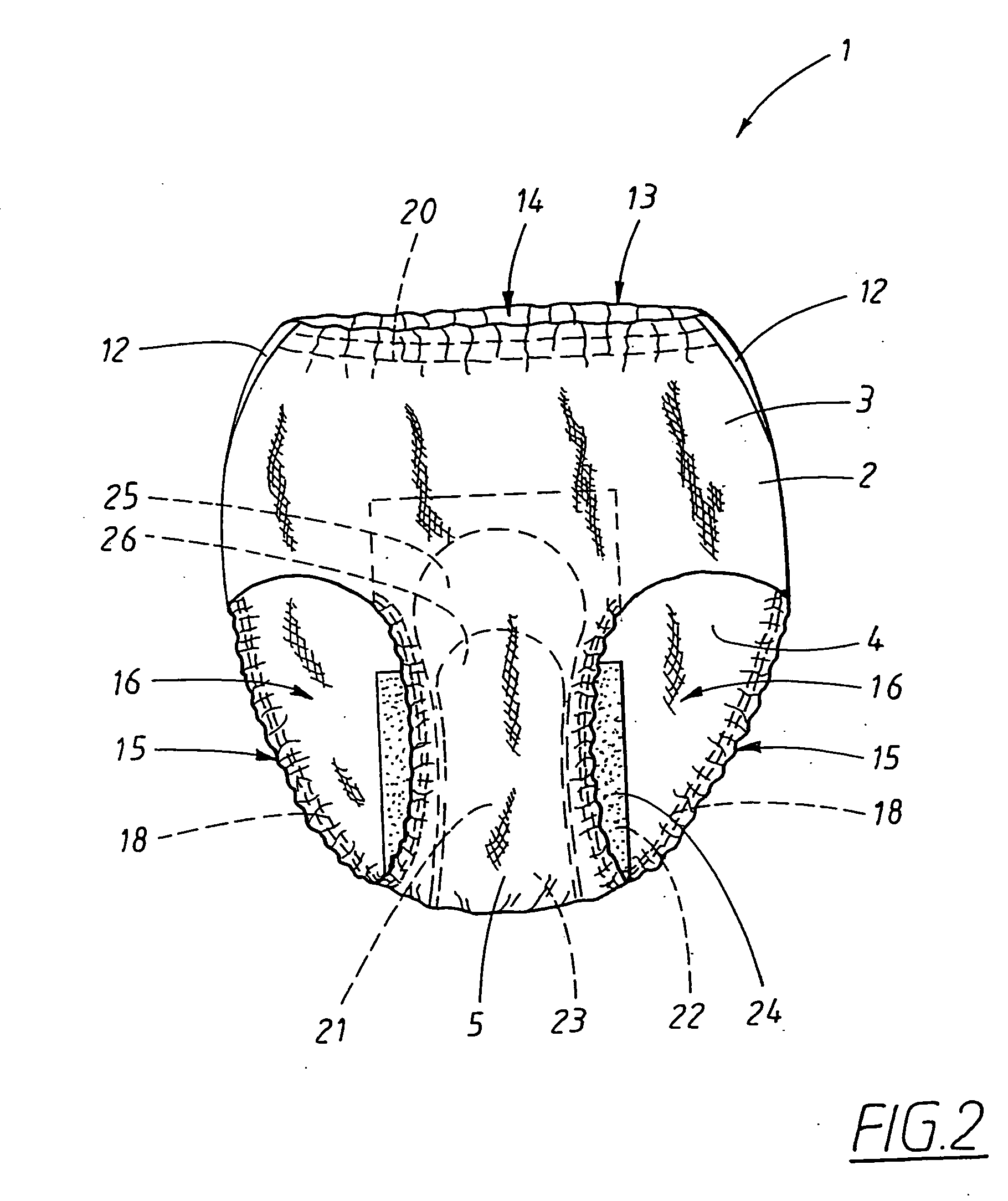

Pant-shaped article with improved fit

ActiveUS20080161767A1Eliminate pressureEliminate riskBaby linensTamponsEngineeringMechanical engineering

A pant shaped garment having a rear portion, a front portion, and a crotch portion, a waist opening with a waist edge and two leg openings bordered by a leg edge having a front part located generally on the front portion and a rear part located generally on the rear portion and on the crotch portion. Front and rear portions are mutually connected in two side joins which run from the waist opening to each leg opening. An elongated elastic element is pre-stretched along the rear part of the leg edge of each leg opening. The front portion comprises an elastically extensible material and the elongated elastic element constricts the rear part of the leg edge, thereby stretching the elastic material along the front part of the leg edge. The side joins exhibit a curvature in a direction towards the rear portion that increases in a direction from the waist opening towards the leg opening.

Owner:ESSITY HYGIENE & HEALTH AB

Atomic layer deposition with nitridation and oxidation

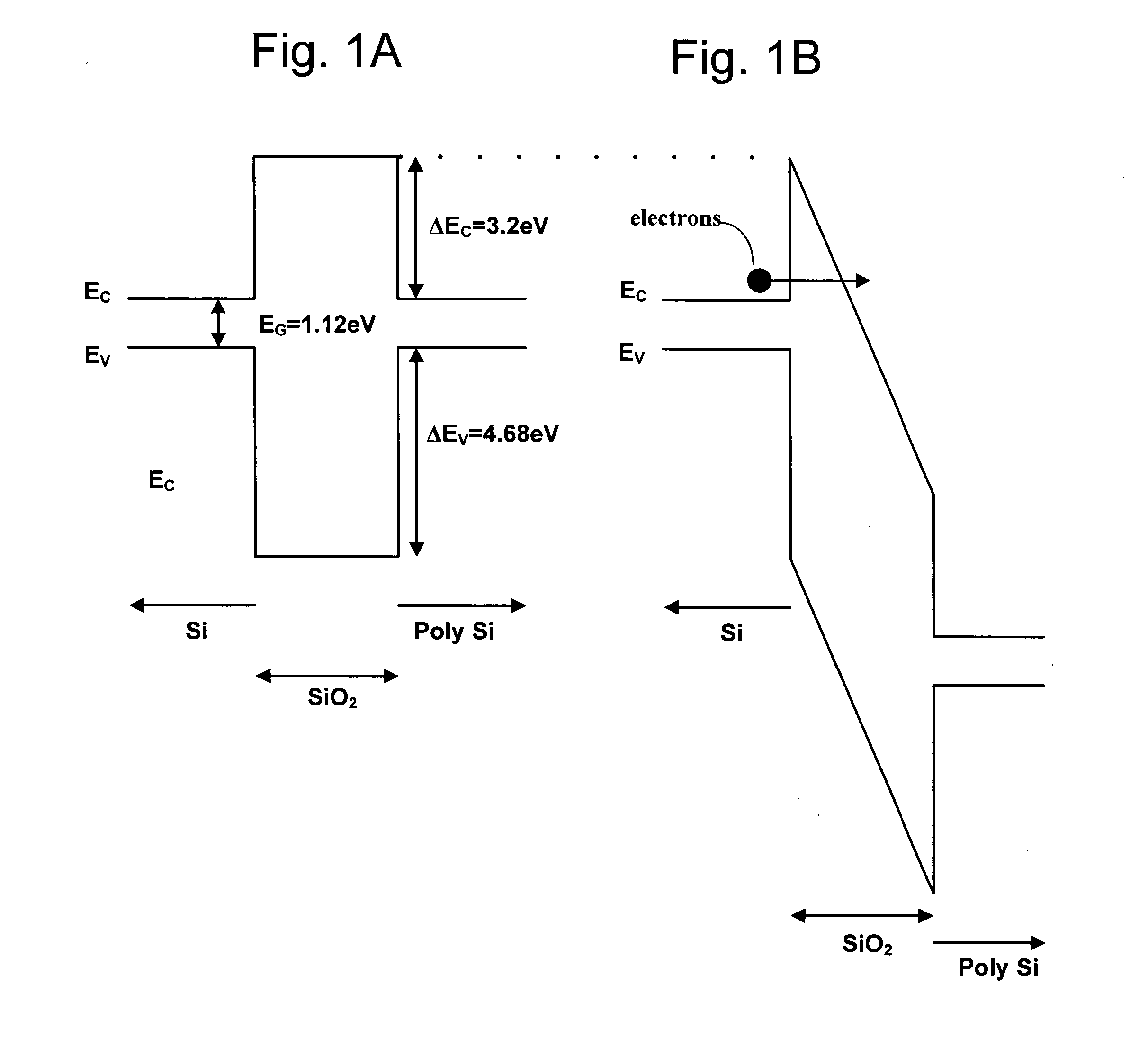

InactiveUS20070059945A1Control performanceSave stepsSolid-state devicesRead-only memoriesConduction bandDielectric layer

A dielectric layer is created for use with non-volatile memory and / or other devices. The dielectric layer is created using atomic layer deposition to deposit multiple components whose mole fractions change as a function of depth in the dielectric layer in order to create a rounded bottom of a conduction band profile for the dielectric layer. In one embodiment, after deposition of the precursors and a purge step, the atomic layer deposition cycle includes a nitridation step that is followed by or overlapped by an oxidation step.

Owner:SANDISK TECH LLC

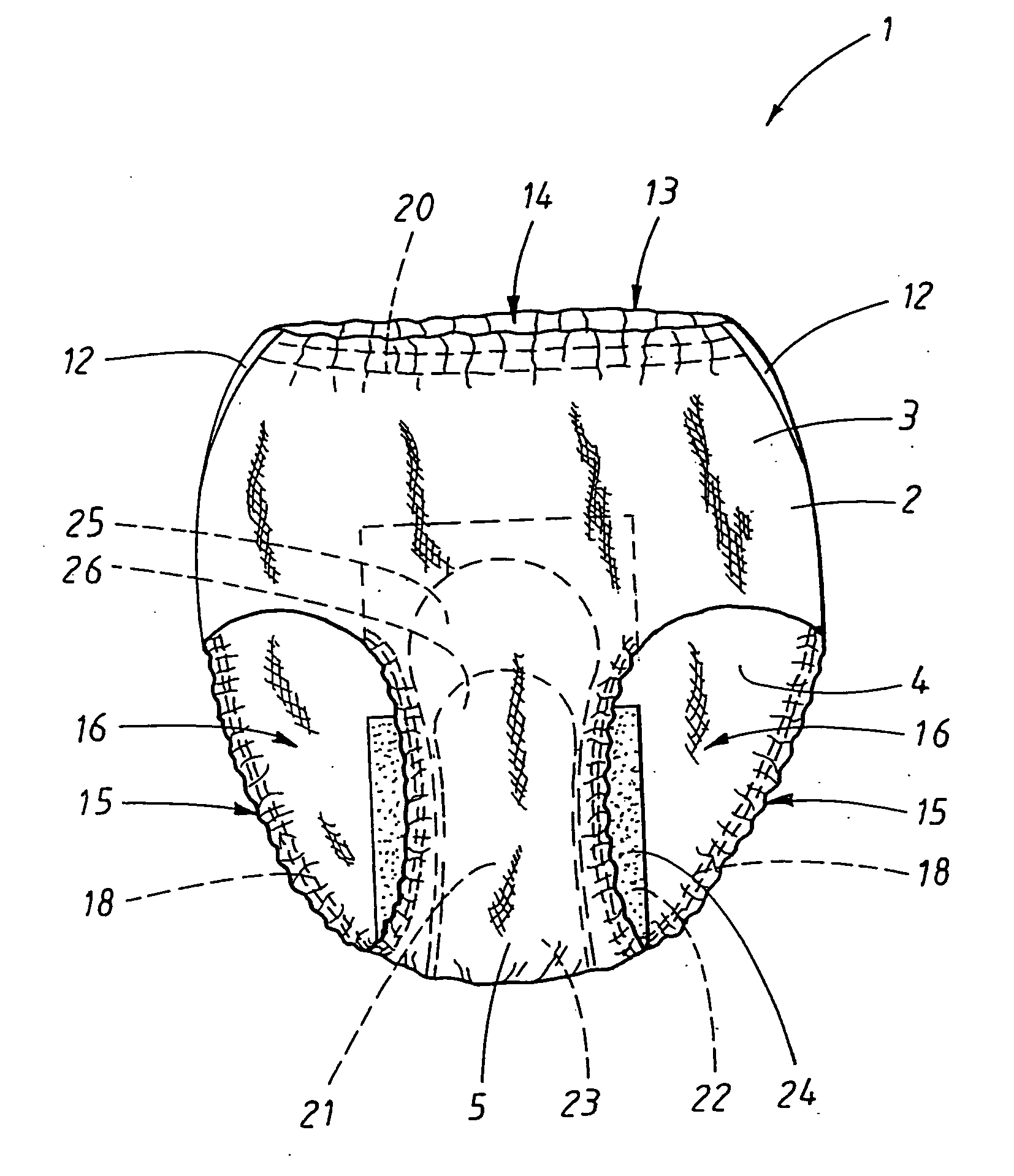

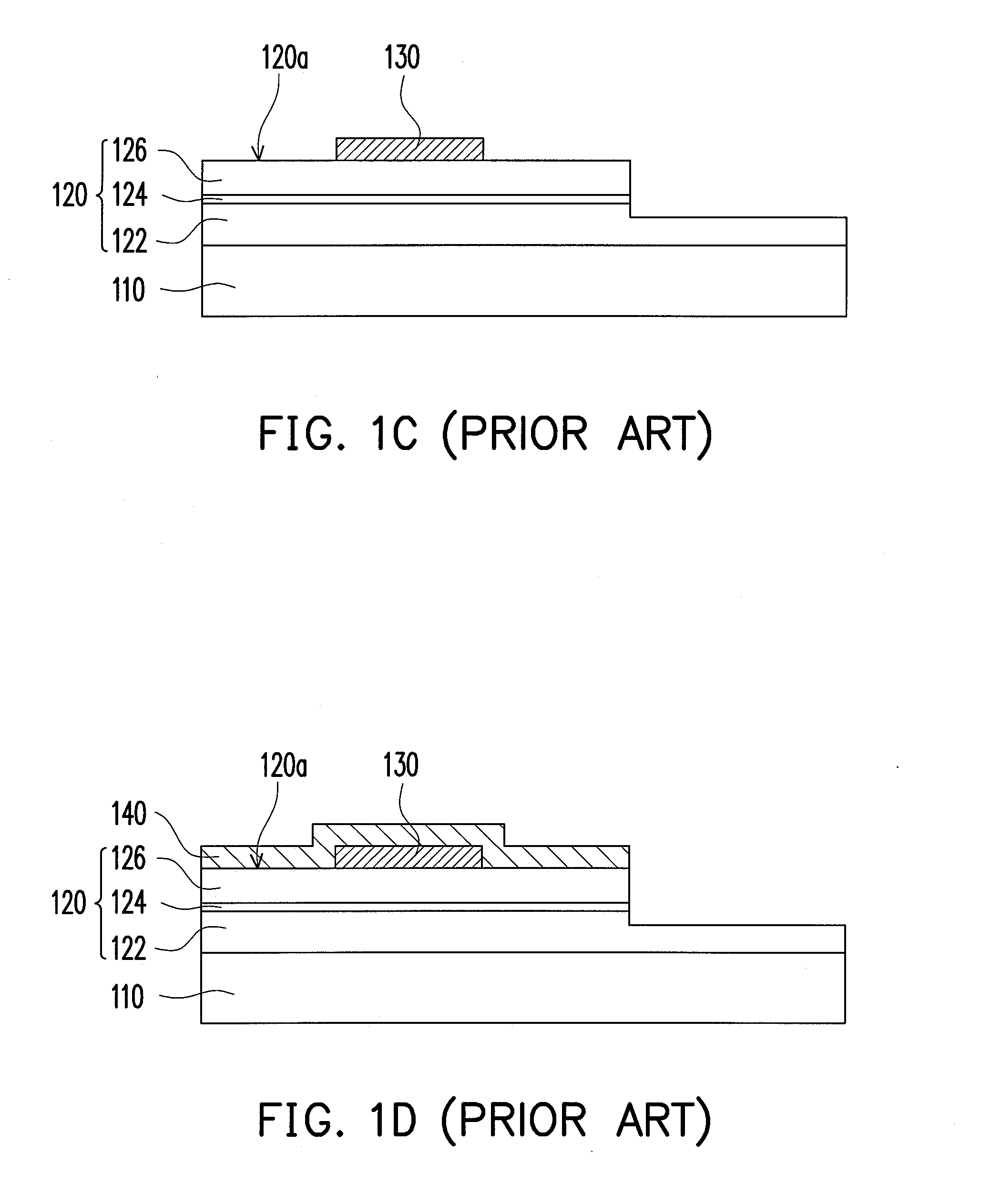

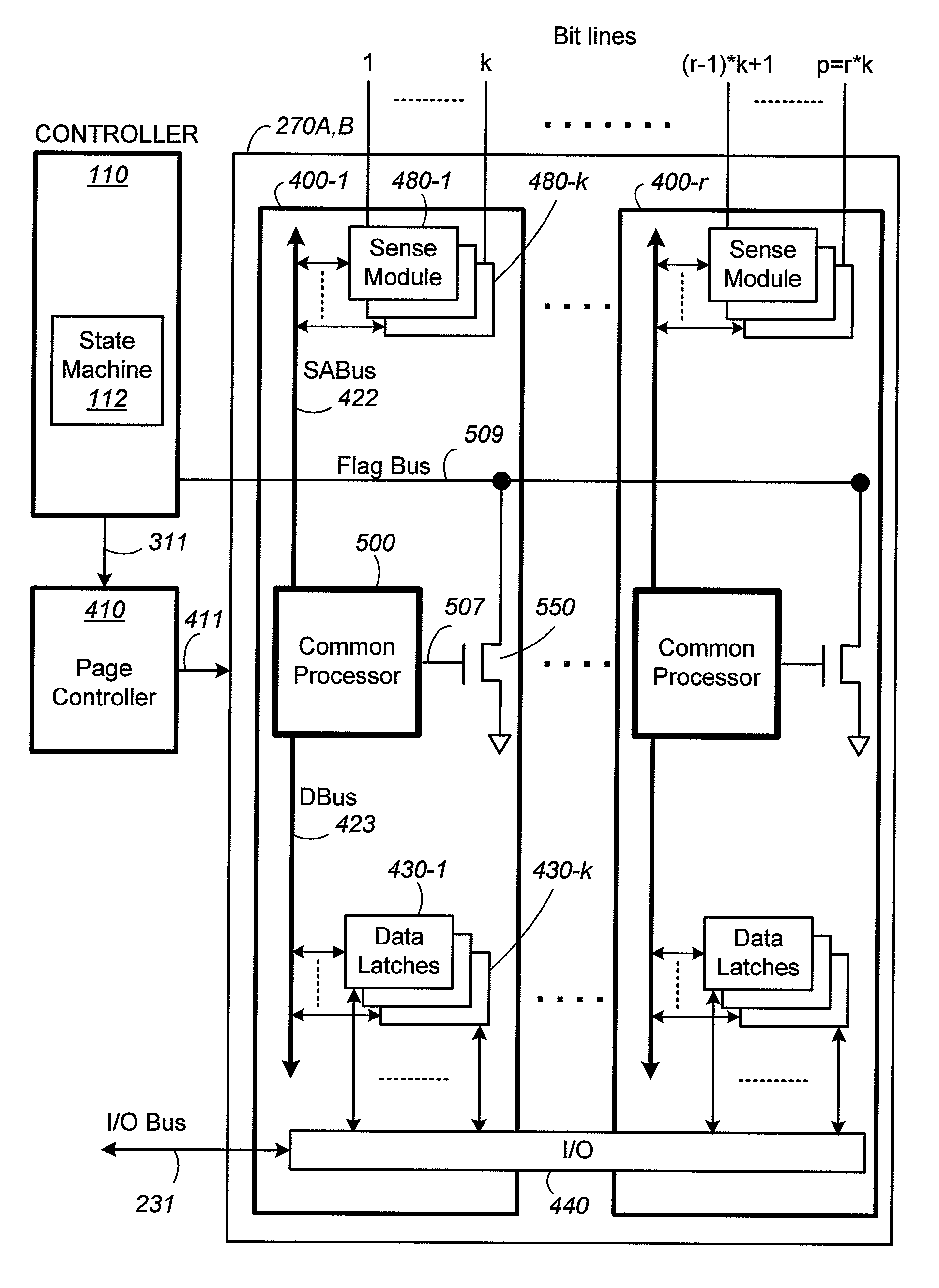

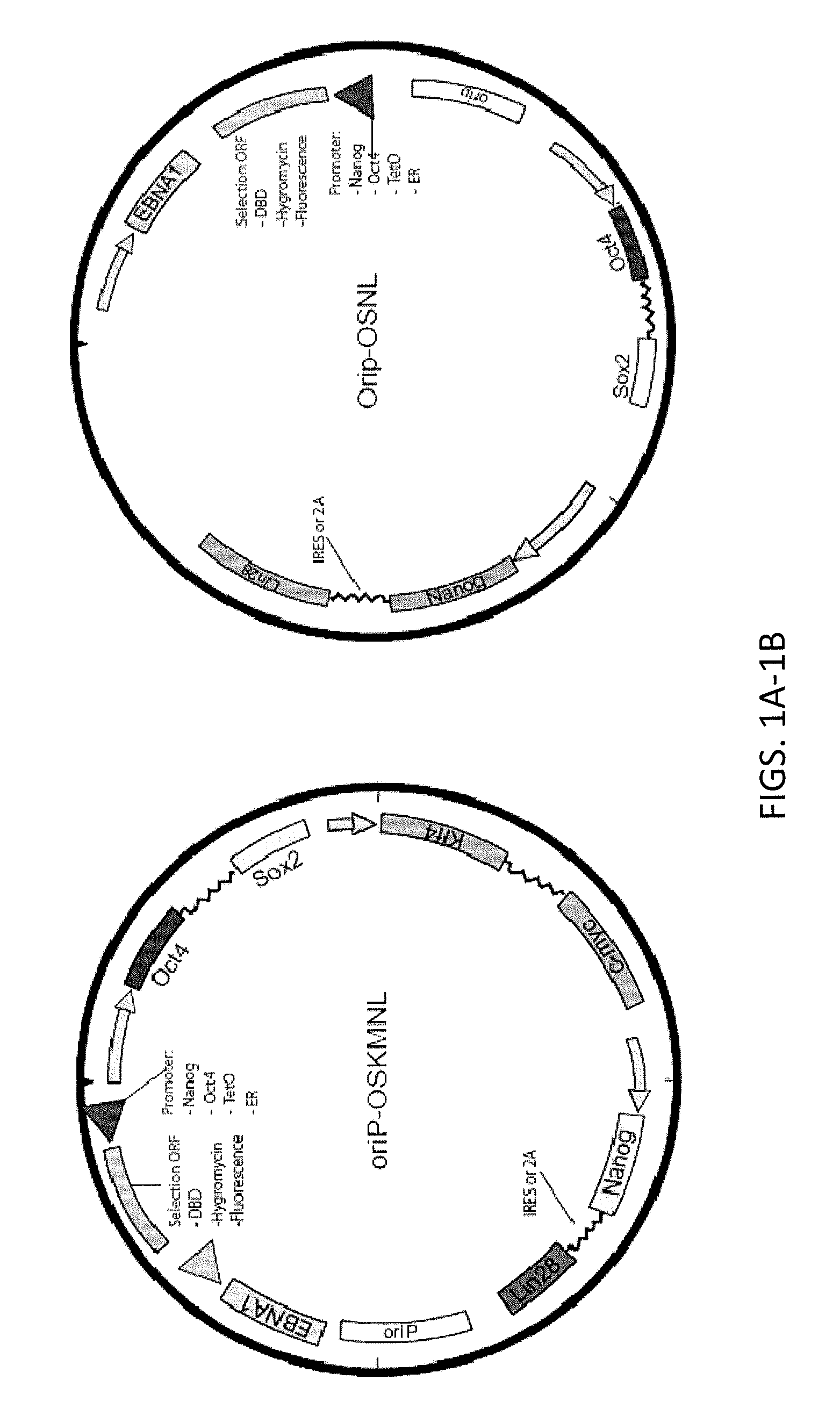

Method for Index Programming and Reduced Verify in Nonvolatile Memory

ActiveUS20090310418A1Improve programming accuracyImprove performanceRead-only memoriesDigital storageMultiple passProgramming process

In a non-volatile memory a group of memory cells is programmed respectively to their target states in parallel using a multiple-pass index programming method which reduces the number of verify steps. For each cell a program index is maintained storing the last programming voltage applied to the cell. Each cell is indexed during a first programming pass with the application of a series of incrementing programming pulses. The first programming pass is followed by verification and one or more subsequent programming passes to trim any short-falls to the respective target states. If a cell fails to verify to its target state, its program index is incremented and allows the cell to be programmed by the next pulse from the last received pulse. The verify and programming pass are repeated until all the cells in the group are verified to their respective target states. No verify operations between pulses are necessary.

Owner:SANDISK TECH LLC

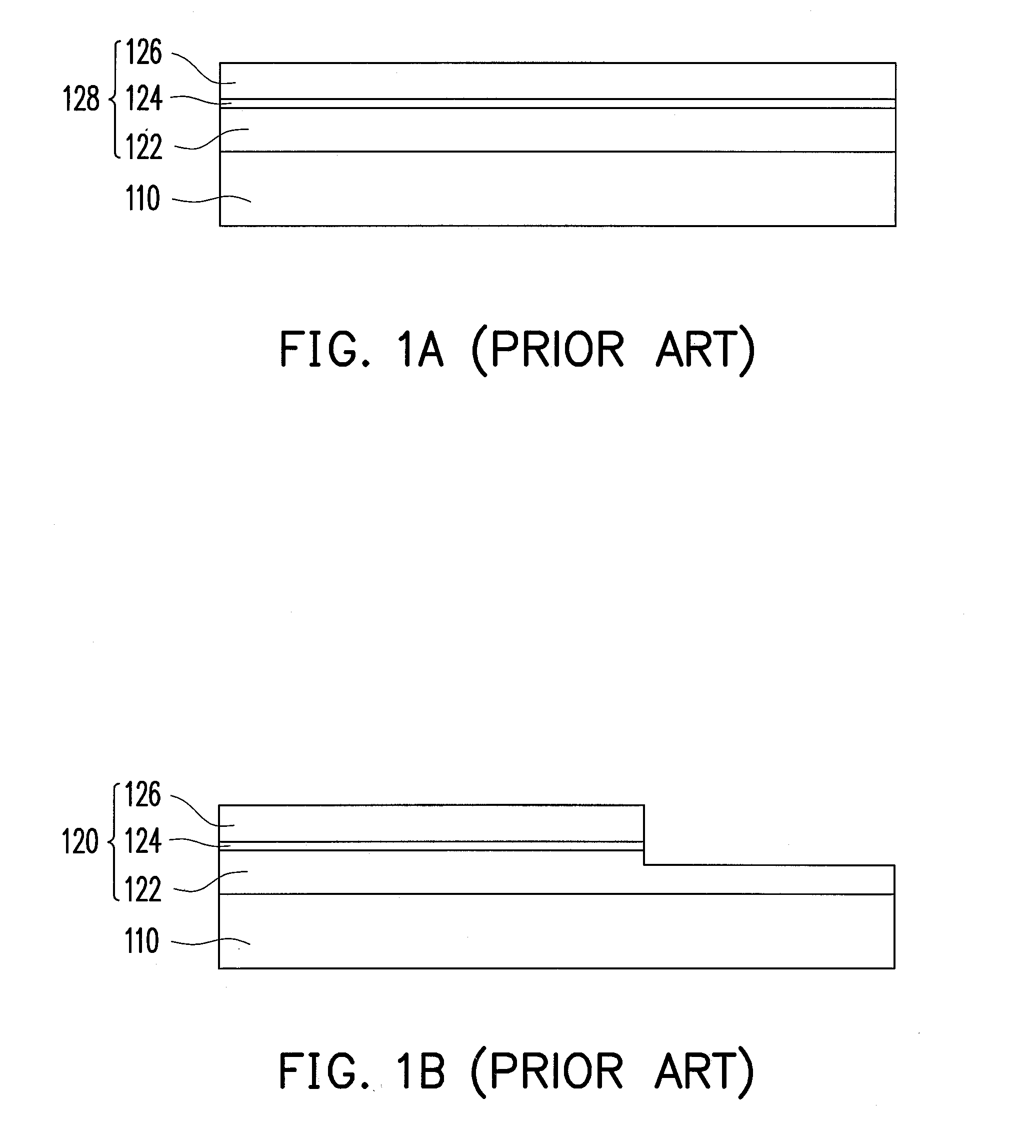

Method for fabricating light emitting diode chip

ActiveUS20100015742A1Reduce time and costReduce processing stepsSolid-state devicesSemiconductor/solid-state device manufacturingColor toneDiode

A method for fabricating a light emitting diode chip is provided. In the method, a half-tone mask process, a gray-tone mask process or a multi-tone mask process is applied and combined with a lift-off process to further reduce process steps of the light emitting diode chip. In the present invention, some components may also be simultaneously formed by an identical process to reduce the process steps of the light emitting diode chip. Consequently, the fabricating method of the light emitting diode provided in the present invention reduces the cost and time for the fabrication of the light emitting diode.

Owner:LEXTAR ELECTRONICS CORP

Nonvolatile memory with index programming and reduced verify

ActiveUS7826271B2Save stepsTighten distributionRead-only memoriesDigital storageTheoretical computer scienceInductive programming

In a non-volatile memory a group of memory cells is programmed respectively to their target states in parallel using a multiple-pass index programming method which reduces the number of verify steps. For each cell a program index is maintained storing the last programming voltage applied to the cell. Each cell is indexed during a first programming pass with the application of a series of incrementing programming pulses. The first programming pass is followed by verification and one or more subsequent programming passes to trim any short-falls to the respective target states. If a cell fails to verify to its target state, its program index is incremented and allows the cell to be programmed by the next pulse from the last received pulse. The verify and programming pass are repeated until all the cells in the group are verified to their respective target states. No verify operations between pulses are necessary.

Owner:SANDISK TECH LLC

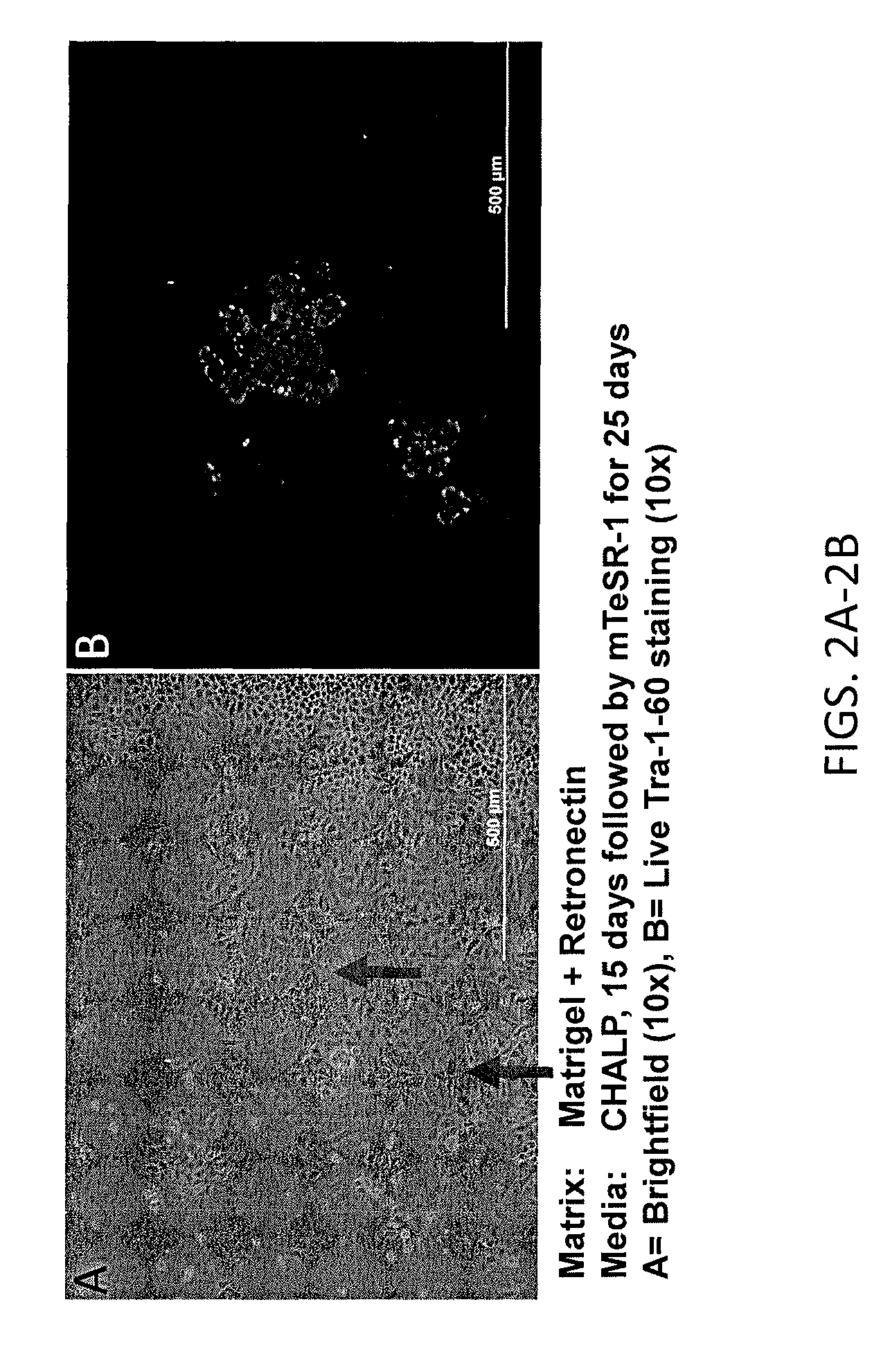

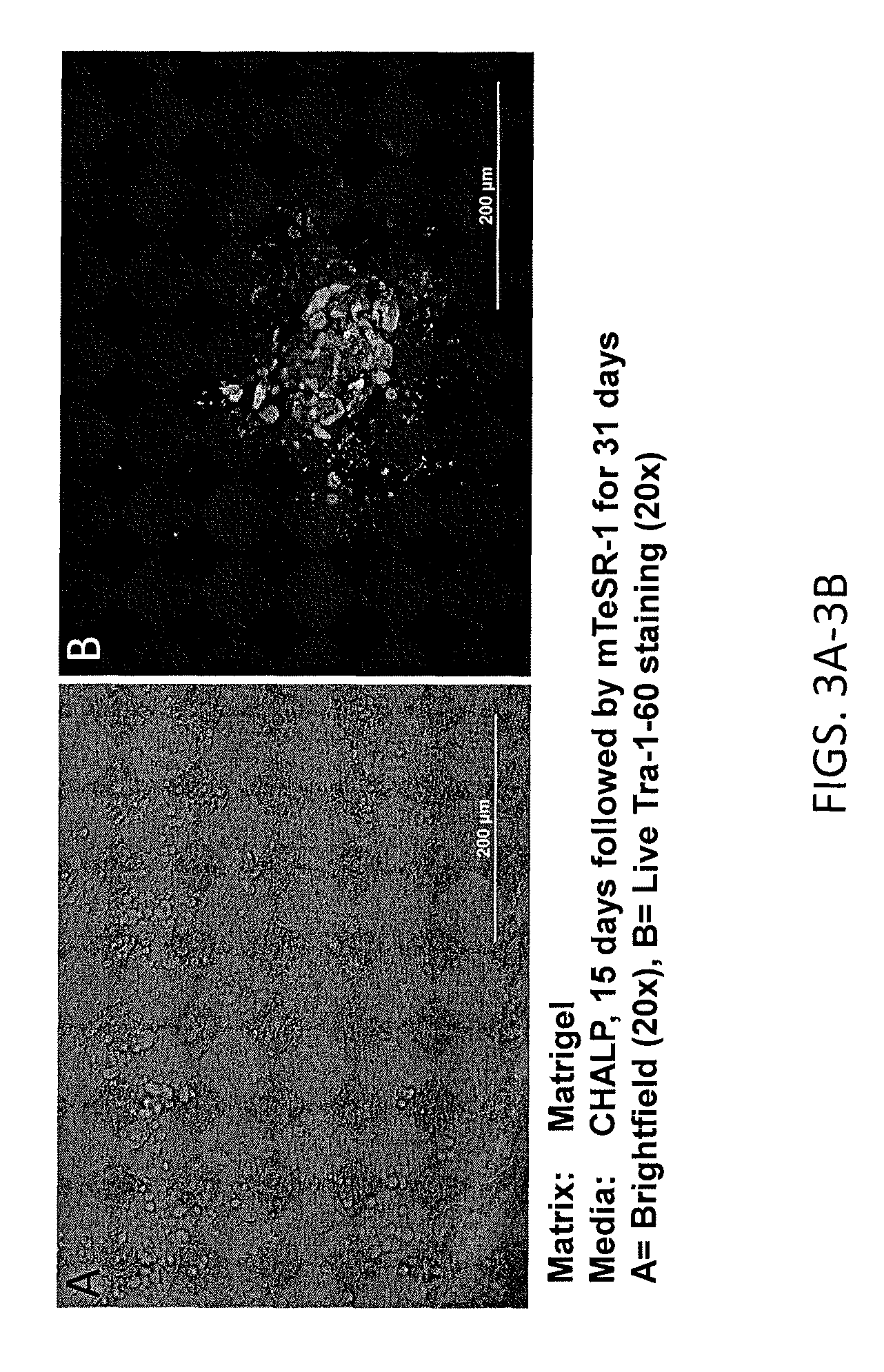

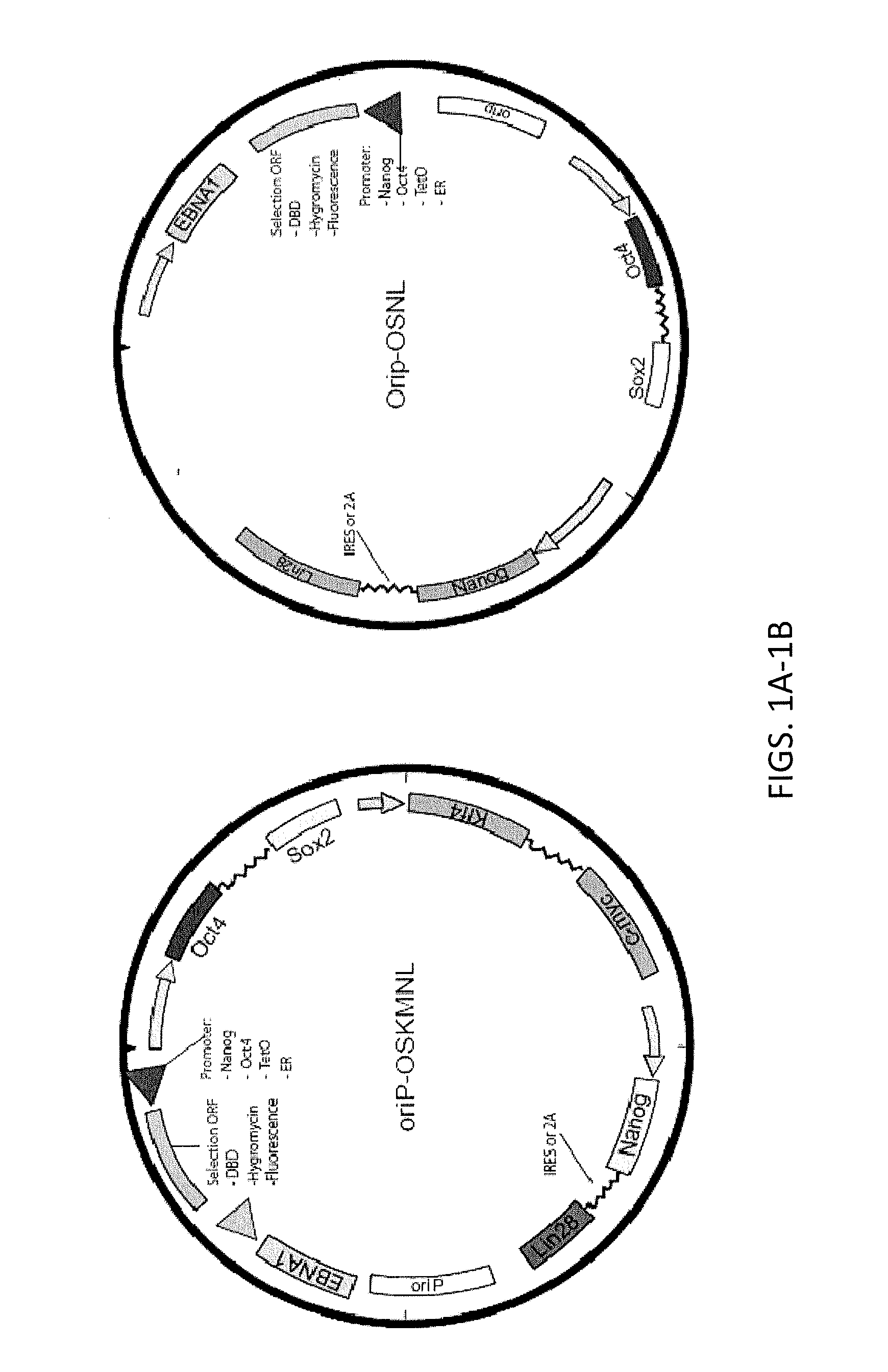

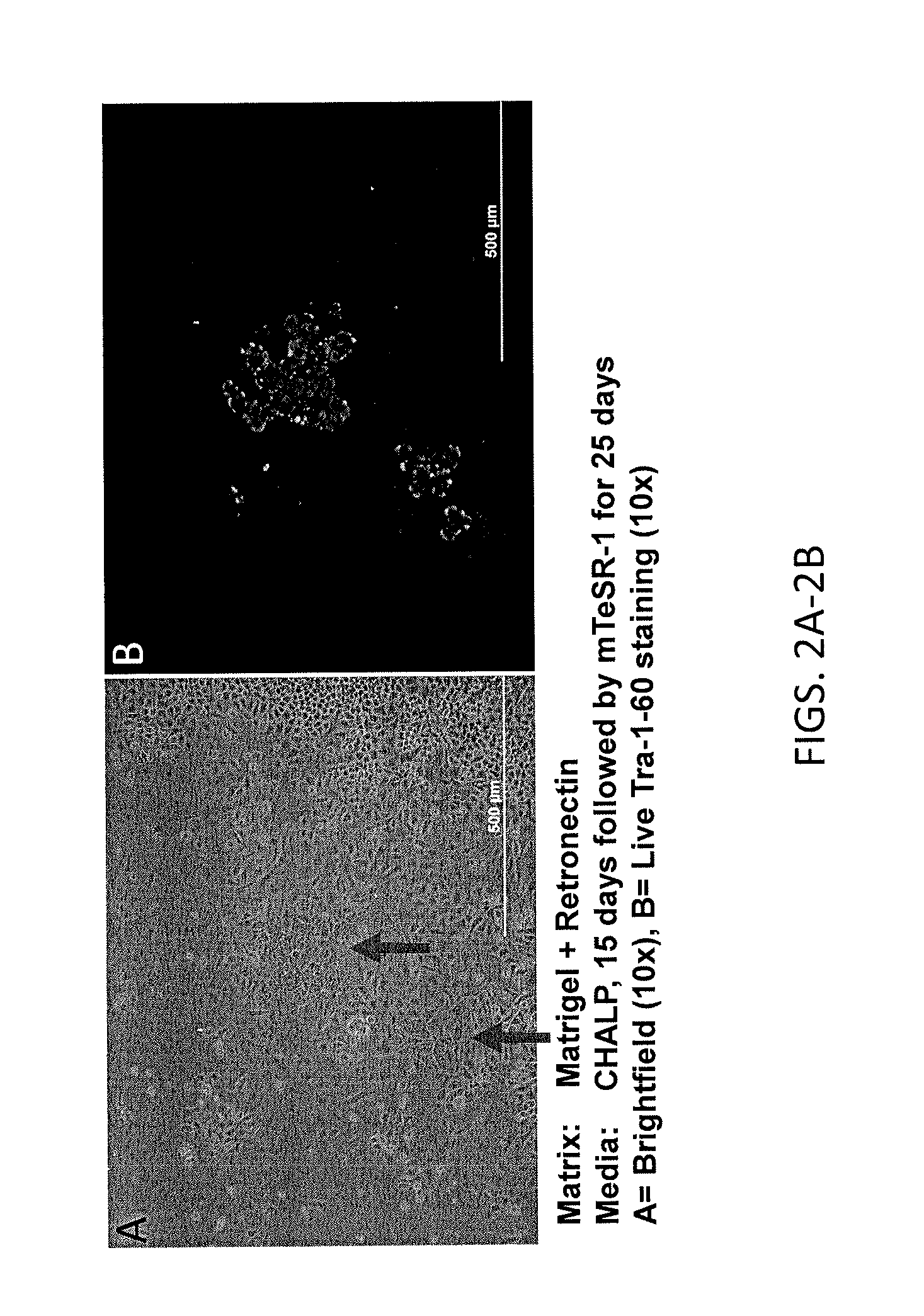

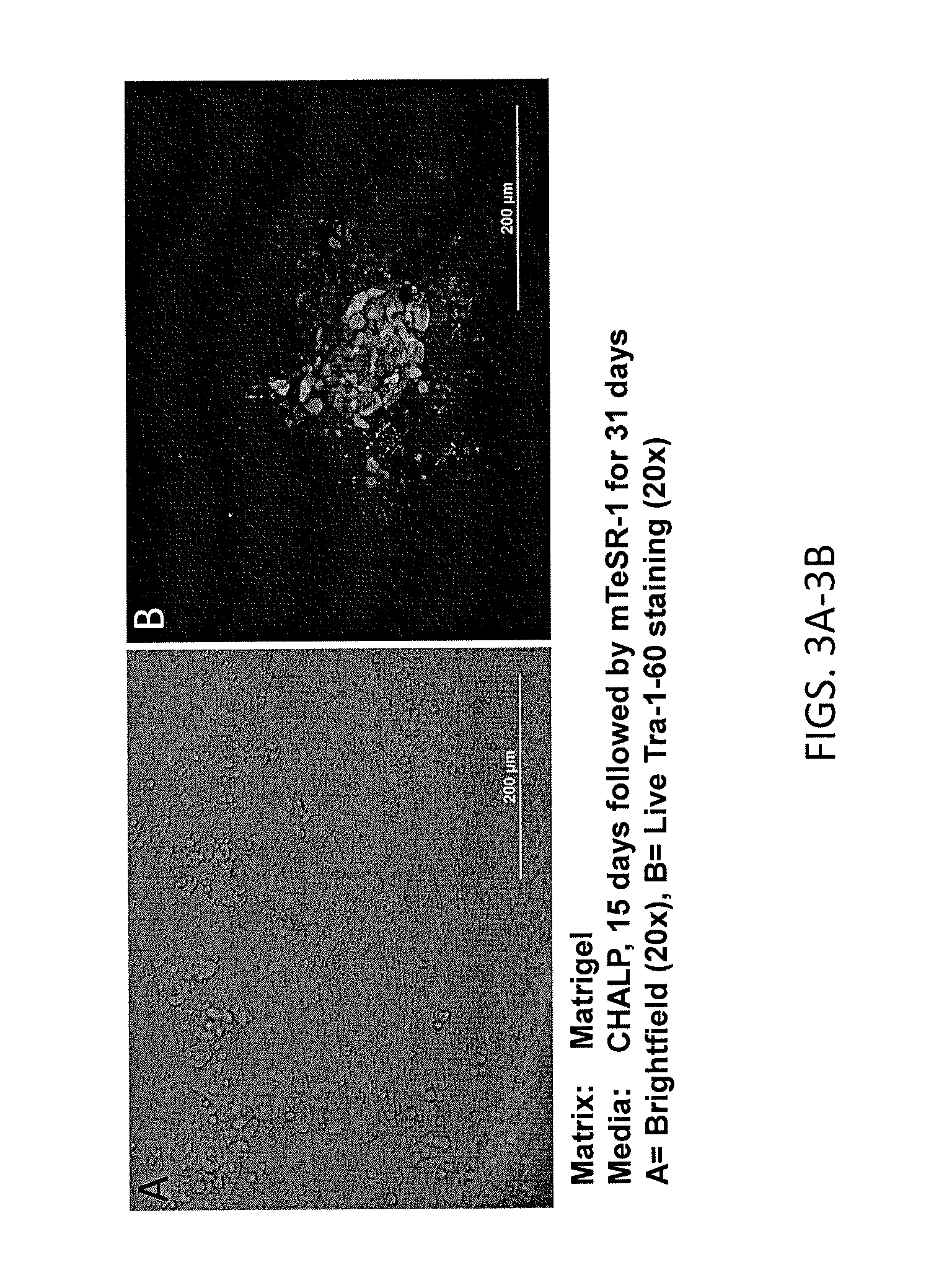

Reprogramming immortalized B-cells to induced pluripotent stem cells

ActiveUS8765470B2Minimize impactHigh reprogramming efficiencyGenetically modified cellsArtificial cell constructsLymphocyteB cell

Methods and composition for providing induced pluripotent stem (iPS) cells are provided. For example, in certain aspects methods including reprogramming B lymphocytes transformed by episomal vectors such as Epstein-Barr virus-based vectors are described. Furthermore, the invention provides induced pluripotent stem cells essentially free of exogenous elements and having B cell immunoglobin variable region rearrangement.

Owner:FUJIFILM CELLULAR DYNAMICS INC

Reprogramming immortalized b cells

ActiveUS20120058562A1High reprogramming efficiencySave stepsGenetically modified cellsArtificial cell constructsLymphocyteB cell

Methods and composition for providing induced pluripotent stem (iPS) cells are provided. For example, in certain aspects methods including reprogramming B lymphocytes transformed by episomal vectors such as Epstein-Barr virus-based vectors are described. Furthermore, the invention provides induced pluripotent stem cells essentially free of exogenous elements and having B cell immunoglobin variable region rearrangement.

Owner:FUJIFILM CELLULAR DYNAMICS INC

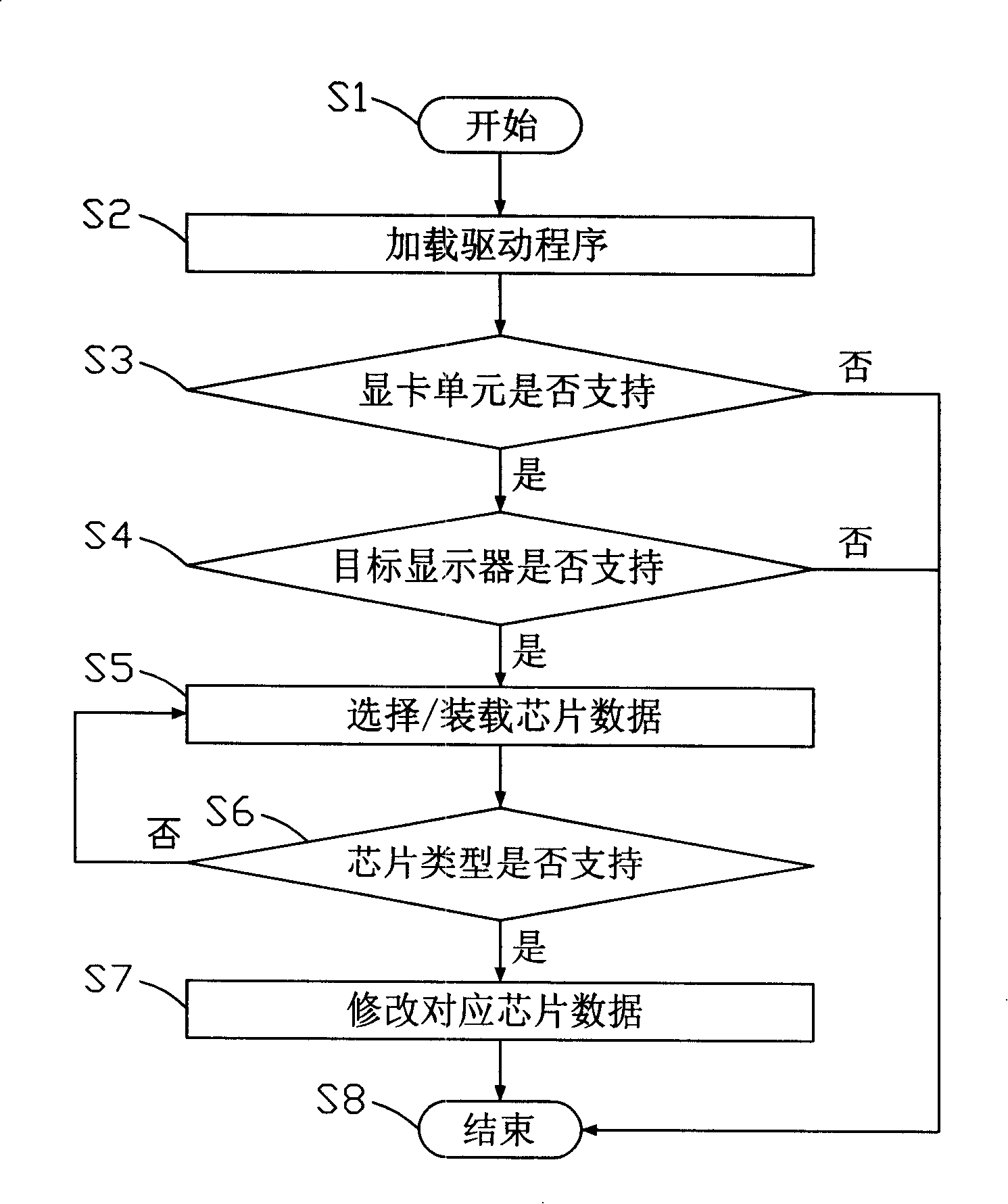

Display equipment debugging system and method thereof

InactiveCN101221524ASimplify the commissioning processSave time during commissioningStatic indicating devicesDetecting faulty computer hardwareGraphicsGraphical user interface

The invention provides a display debug system and a debug method thereof. The display debug system of the invention comprises a host computer and a target display, wherein, the host computer comprises a graphics card unit, a driver layer and an application program layer; the graphic card unit comprises a video graphic array interface; the target display comprises an image zooming chip and a video graphic array interface; wherein, the application program layer comprises a plurality of chip type data and a graphic user interface; the host computer and the target display are connected and communicated with each other through the video graphic array interfaces of each other; the application program layer is communicated with the driver layer through an input and output control channel; the driver layer controls and drives the graphics card unit for reading and writing the image zooming chip; data of the image zooming chip is displayed on the target display through the graphic user interface; after modification and debugging, a debug result is directly displayed on the target display. The display debug system of the invention has the advantages of time saving and convenience of the display debug process and is universally used for a plurality of chips.

Owner:INNOCOM TECH SHENZHEN +1

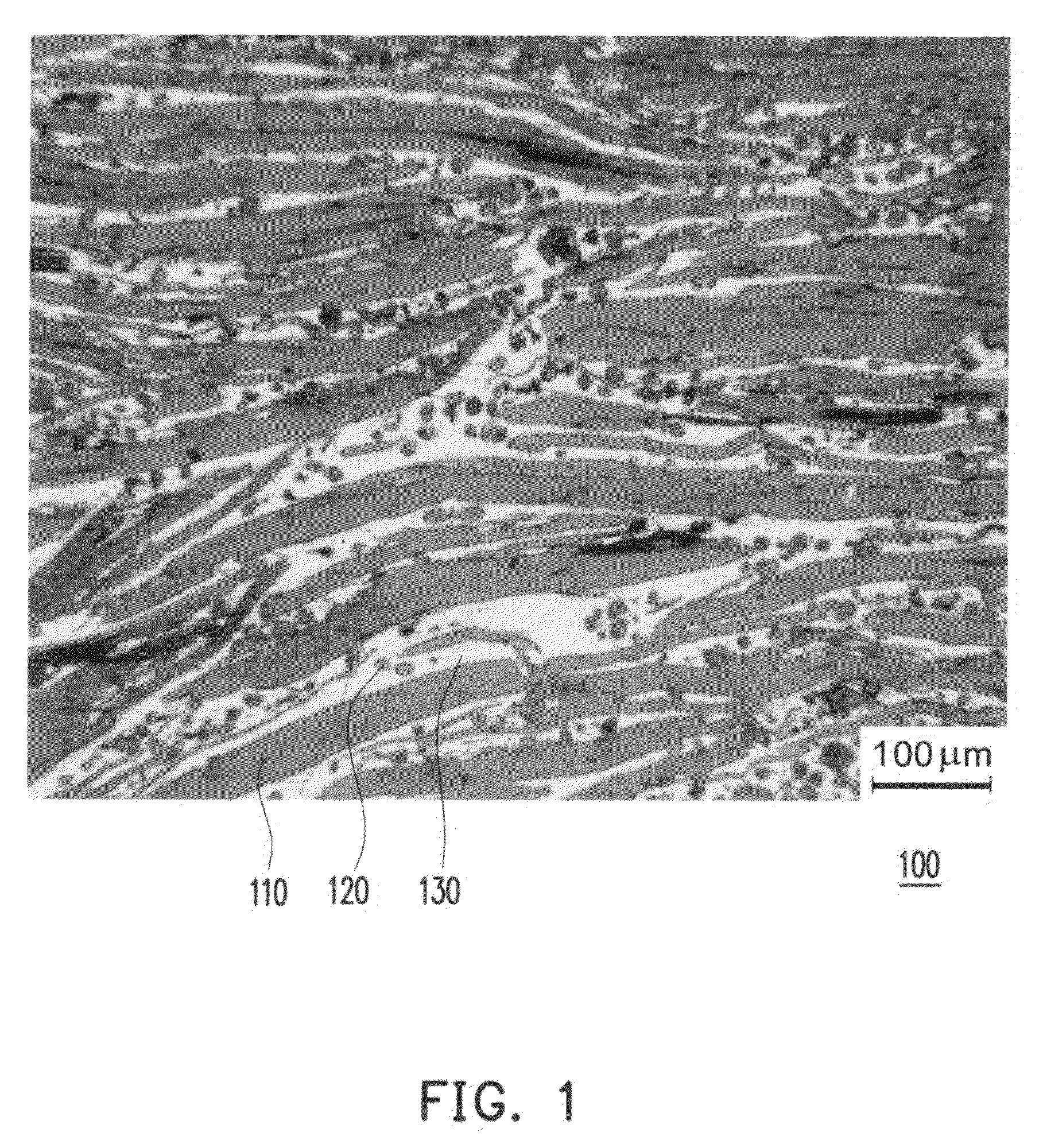

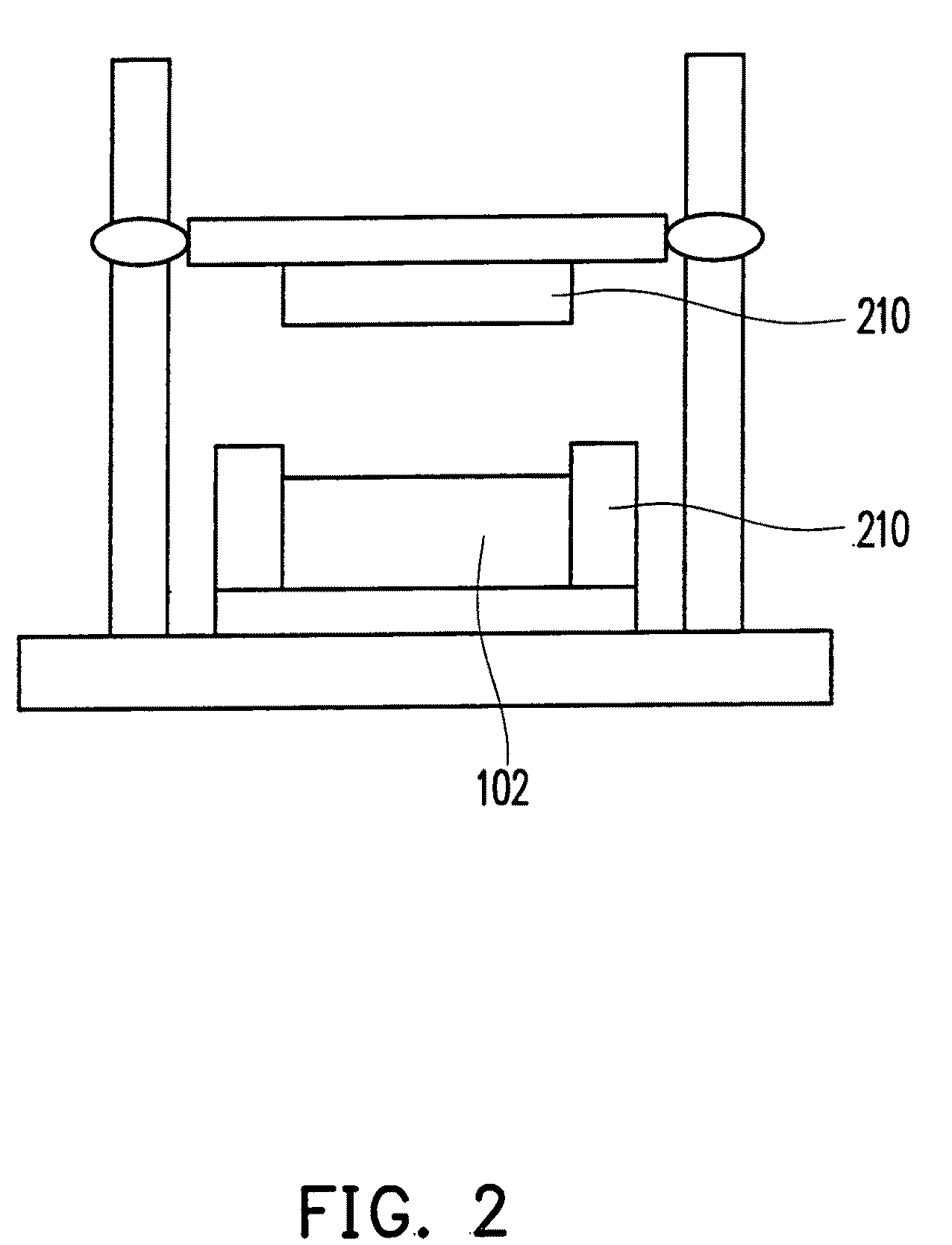

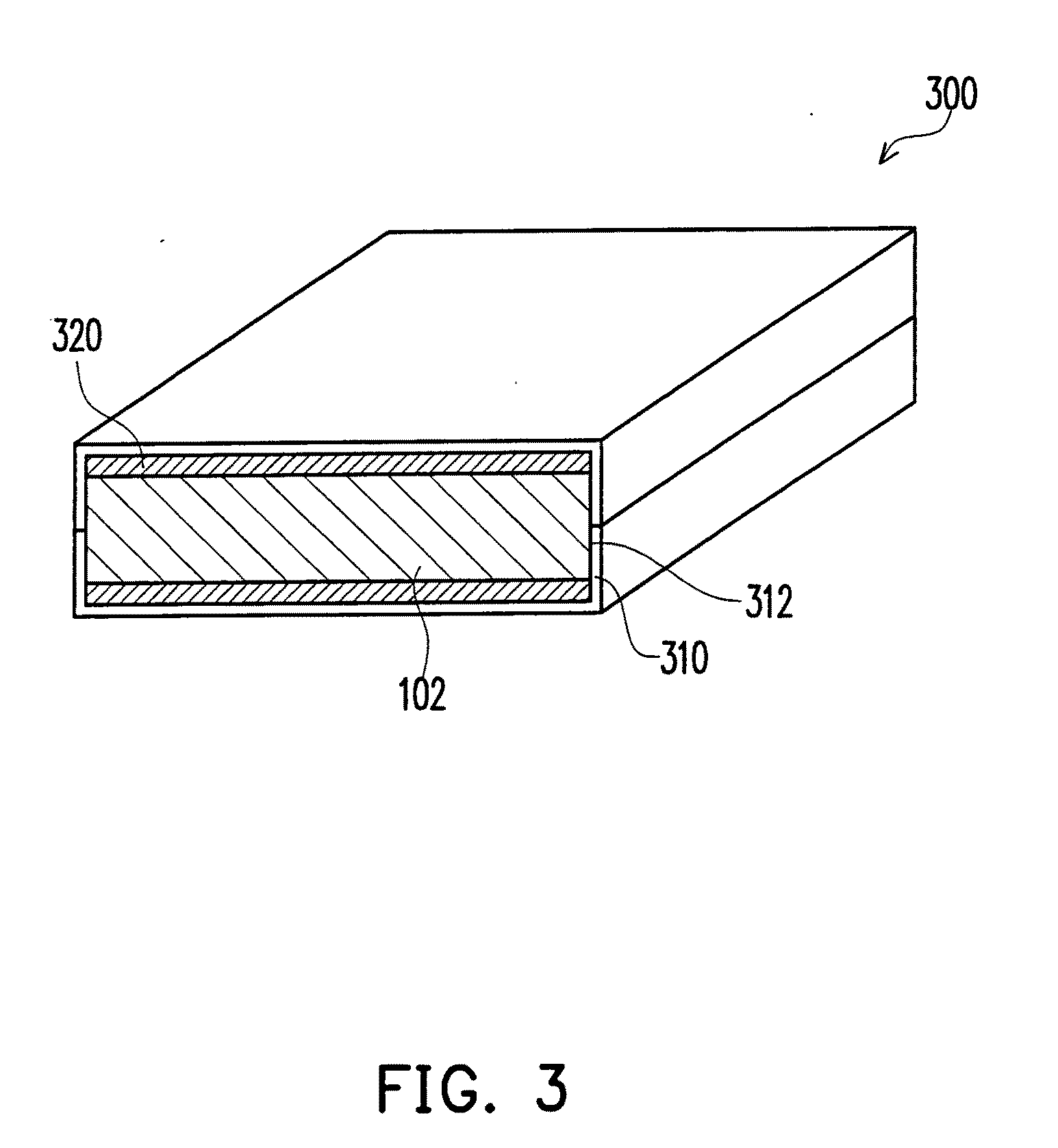

Carbon-Containing Metal-Based Composite Material and Manufacturing Method Thereof

InactiveUS20100163782A1Improve cooling effectImprove thermal conductivityHeat-exchange elementsHeat conductingGraphite

A carbon-containing metal-based composite material and a manufacturing method thereof are provided. The carbon-containing metal-based composite material includes a plurality of graphites, a plurality of heat-conducting reinforcements and a metal matrix. The graphites occupy 35%˜90% in volume. The heat-conducting reinforcements are distributed between the graphites. The heat-conducting reinforcements and the graphites are self-bonded. The heat-conducting reinforcements occupy 5%˜30% in volume and have a thermal conductivity larger than 200 W / mK. The metal matrix is filled between the heat-conducting reinforcements and the graphites, and the metal matrix occupies 5%˜35% in volume.

Owner:IND TECH RES INST

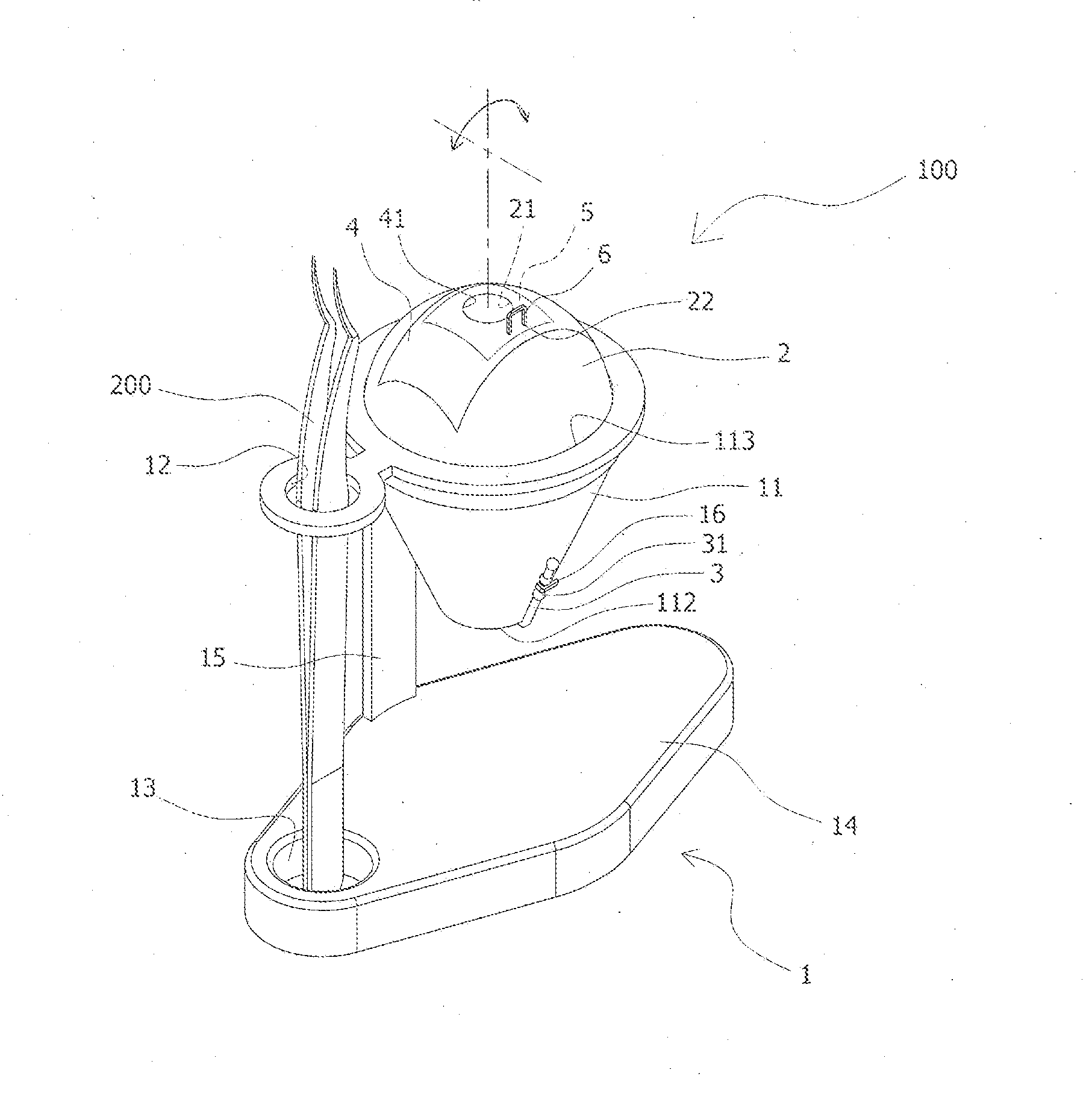

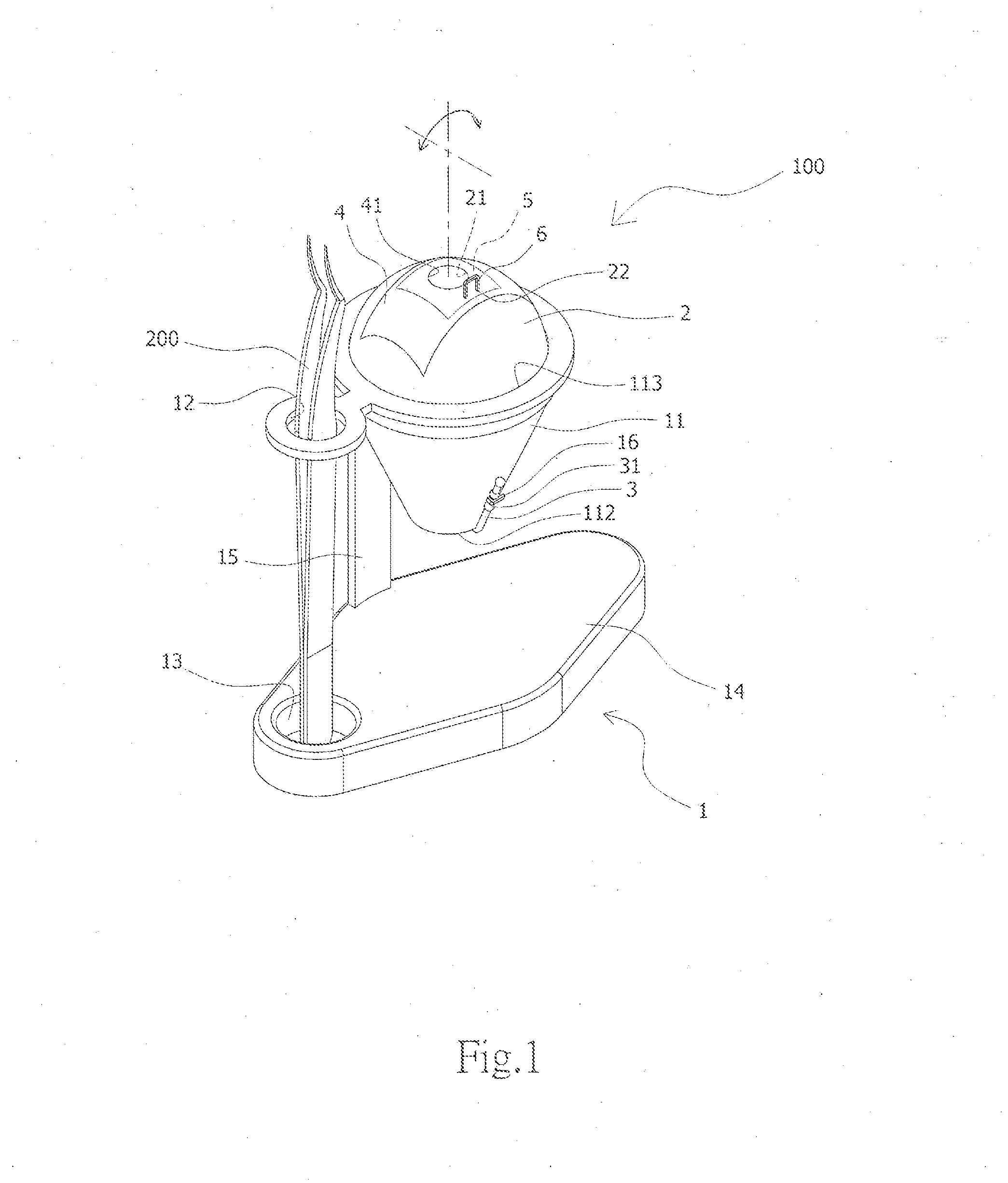

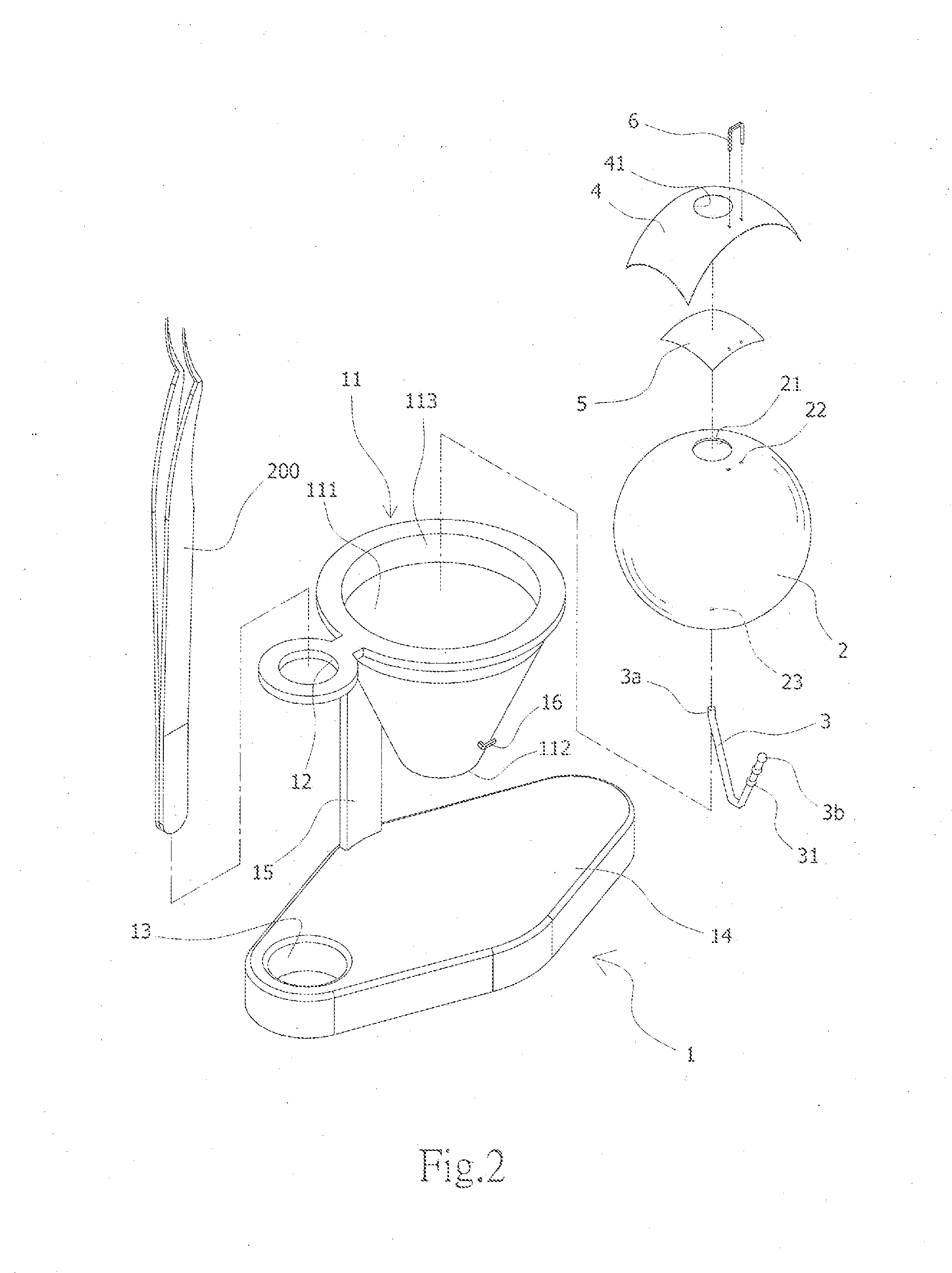

Eye surgery training simulator

InactiveUS20160098944A1Reduce learning costsIncrease success rateEducational modelsElastic componentSurgery training

The present invention provides an eye surgery training simulator that can reduce learning cost and simulate the eyes in a more real way to allow surgery performers in practice to increase the success rate of surgery. The surgery training simulator compromise: a base with the accommodating tank, a hollow sphere inside said accommodating tank with a punched hole at the center of its top to simulate the eyeball rotation; a thin film covering the punched hole of said hollow sphere to simulate anterior capsule; a positioning sheet attached to the top surface of the hollow sphere with a hole corresponding to the punched hole; a positioning plug-in at the side of said punched hole that can limit the displacement of the capsulorhexis forceps; and at least an elastic component that can simulate eyeball muscle by pulling the hollow sphere and restore it after the rotation of the hollow sphere.

Owner:UNIVERSAL VISION BIOTECHNOLOGY CO LTD

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com