Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

123 results about "Relevant Communications" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Enhanced notification for relevant communications

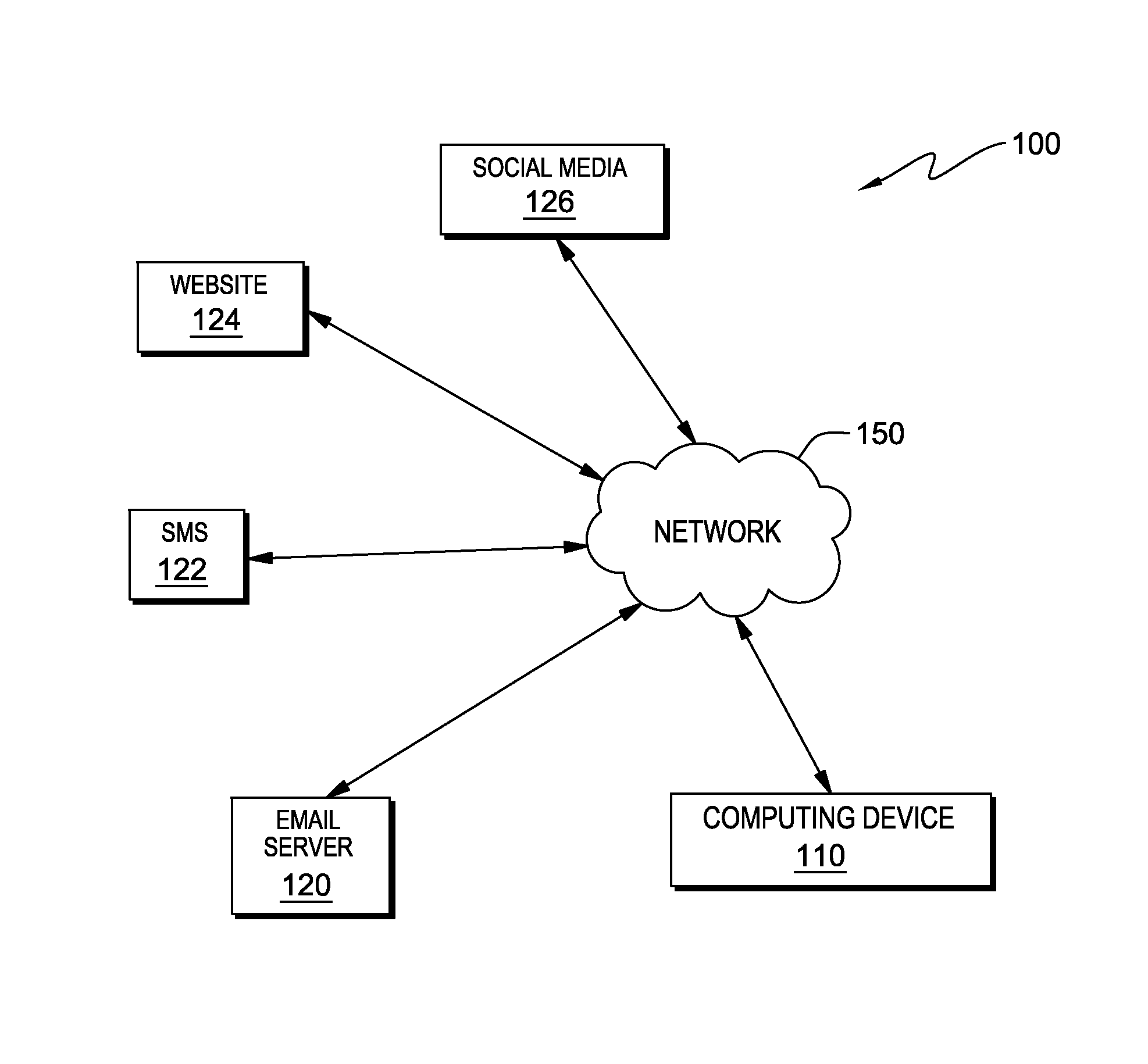

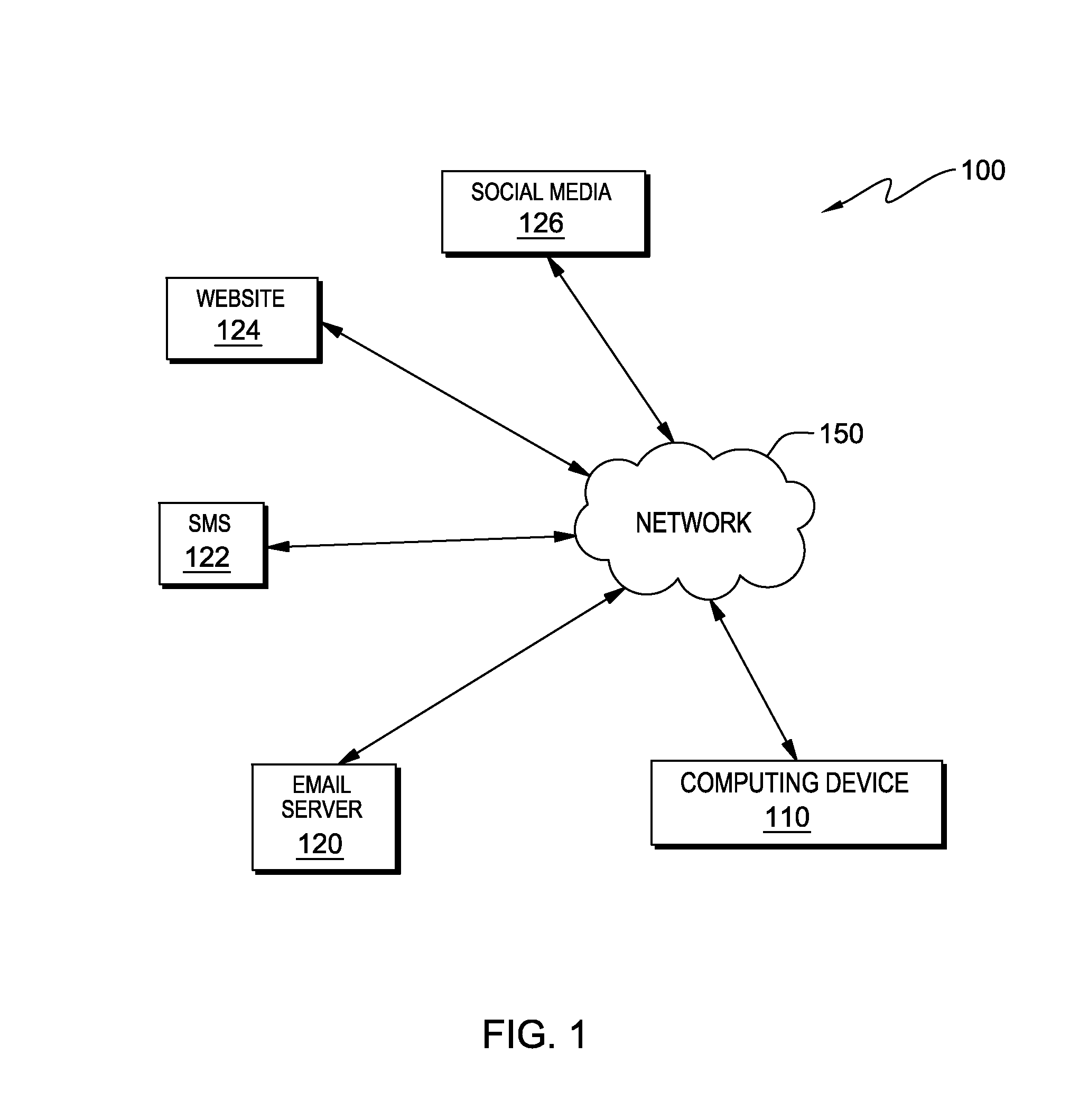

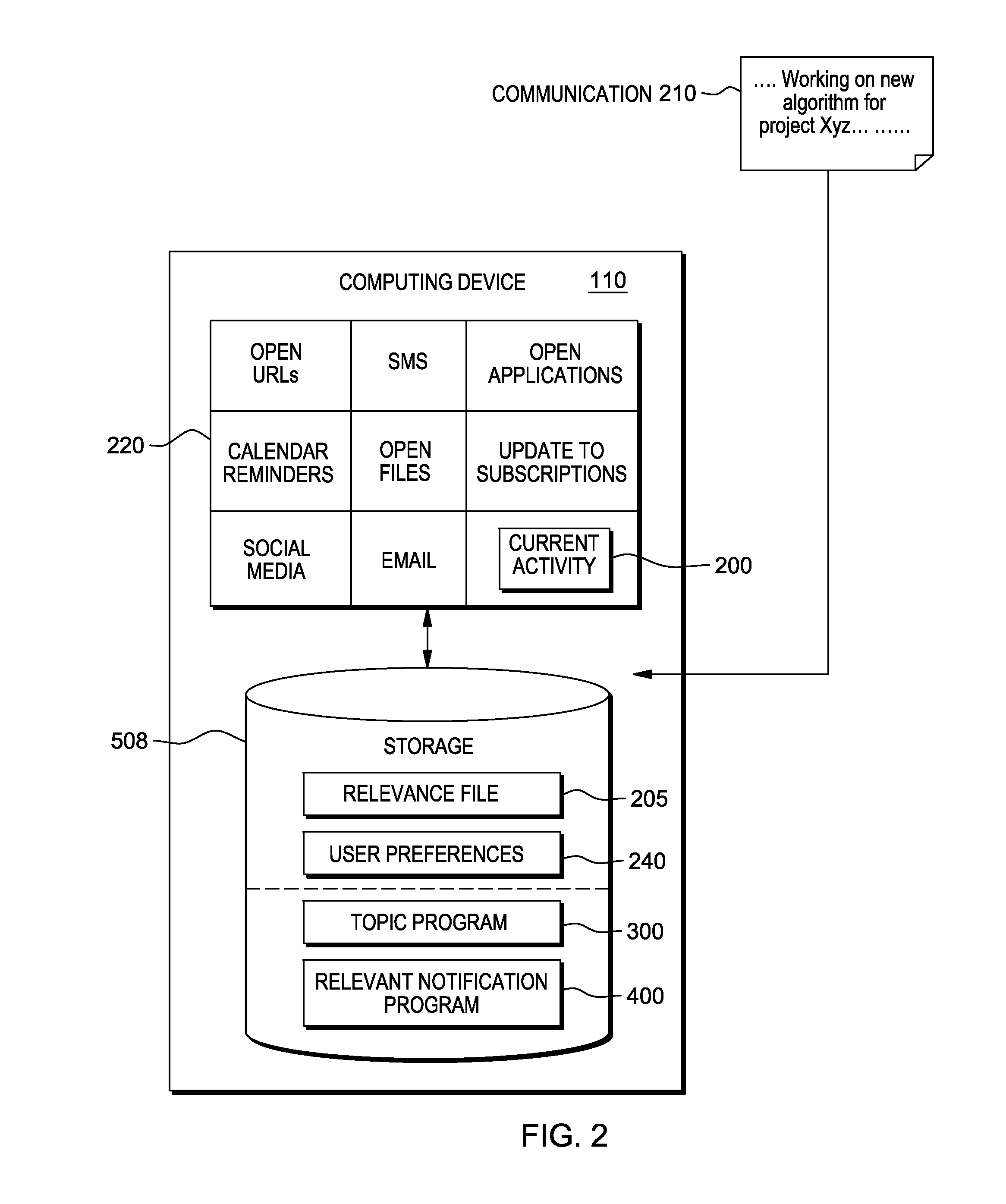

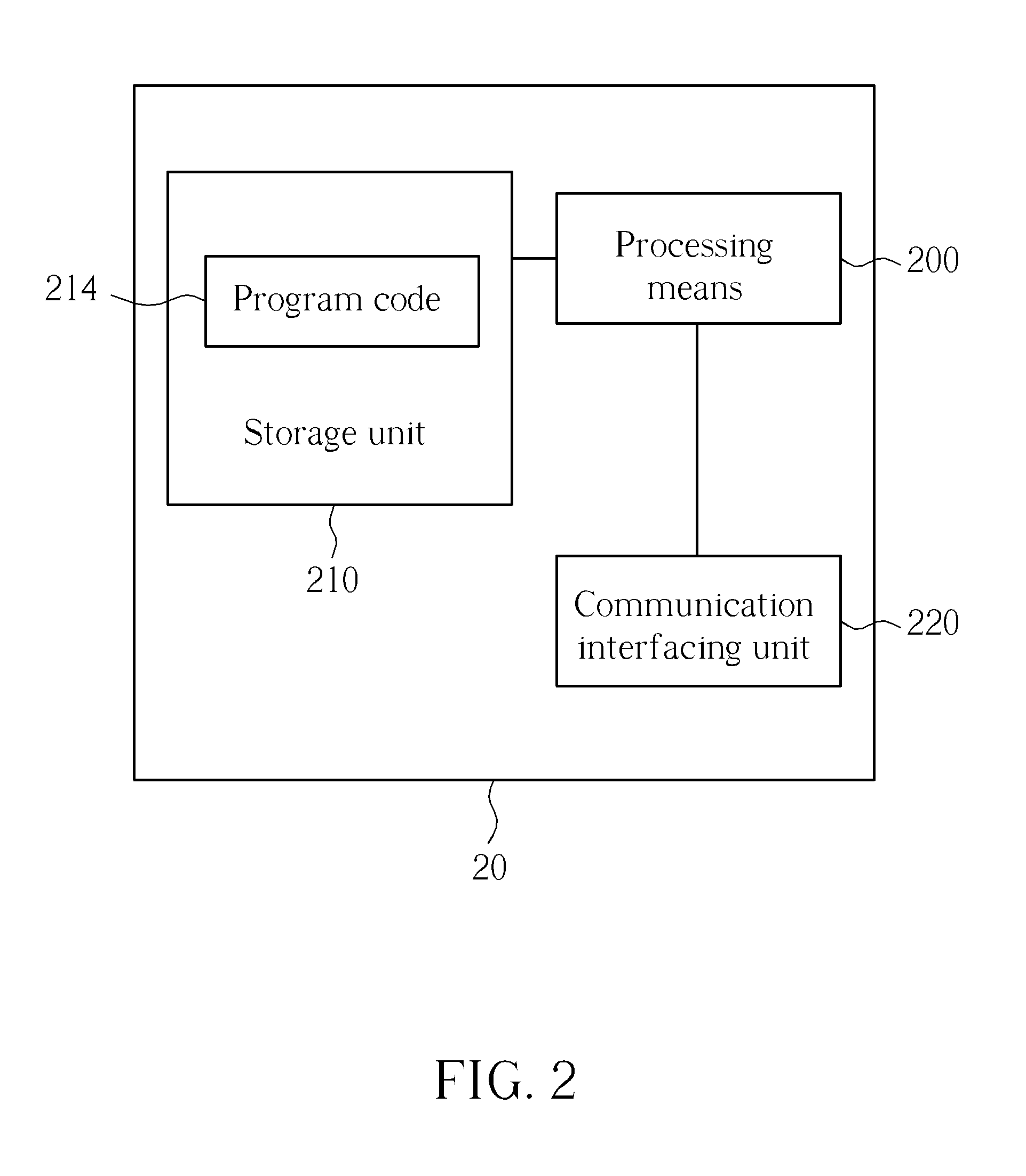

Embodiments of the present invention disclose a method, computer program product, and system for providing a severity of a notification for a communication. A computing device determines a topic and associated information of a current activity, operating on the computing device. The computing device receives a communication and determines the topic and associated information of the communication. The computing device determines a level of relevance between the topic and associated information of the received communication and the topic and associated information of the current activity. The computing device determines whether the level of relevance exceeds a predefined threshold, and in response to determining that the level of relevance exceeds the predefined threshold, the computing device provides a notification, wherein the severity of the notification for the communication is proportional to the level of relevance.

Owner:MAPLEBEAR INC

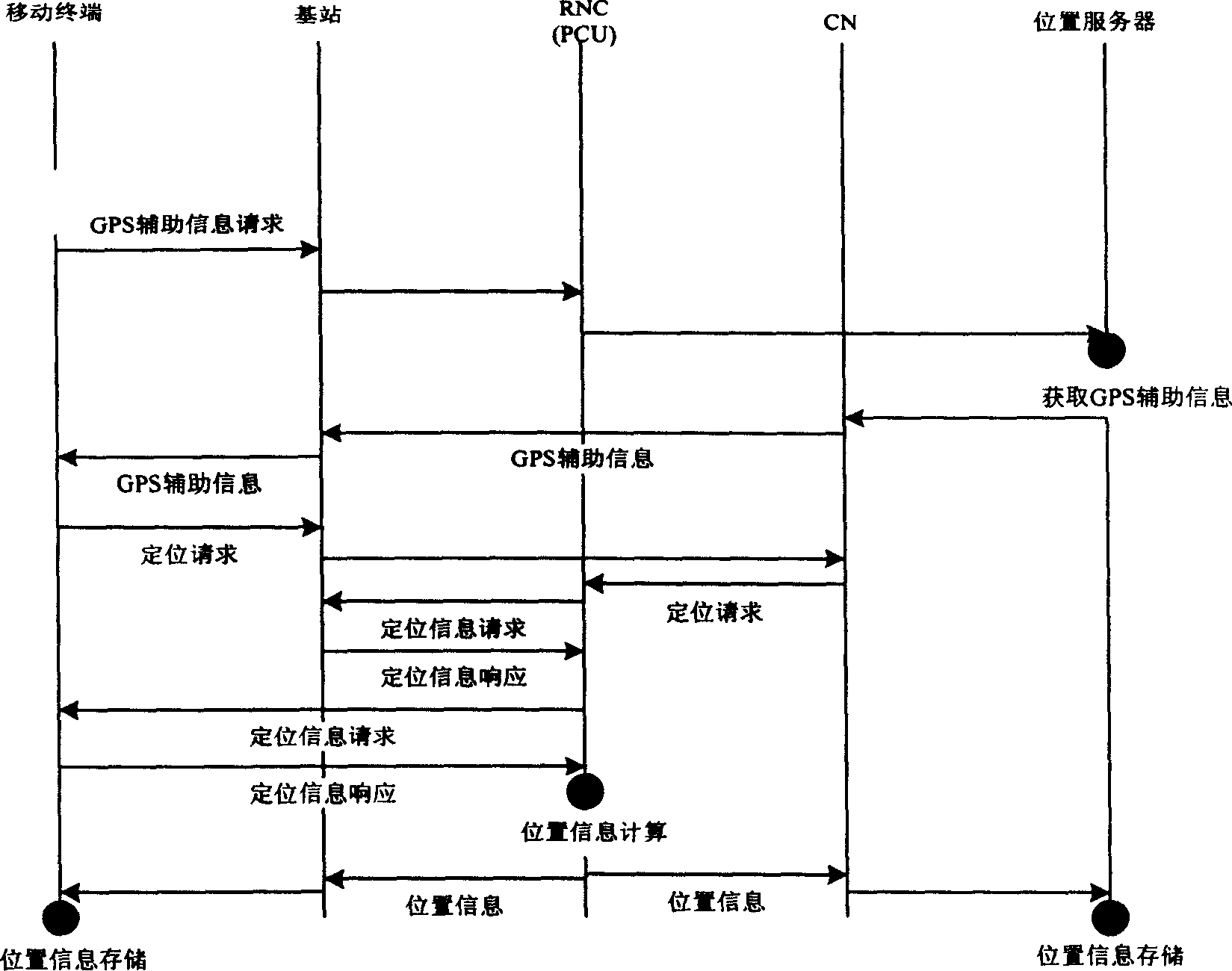

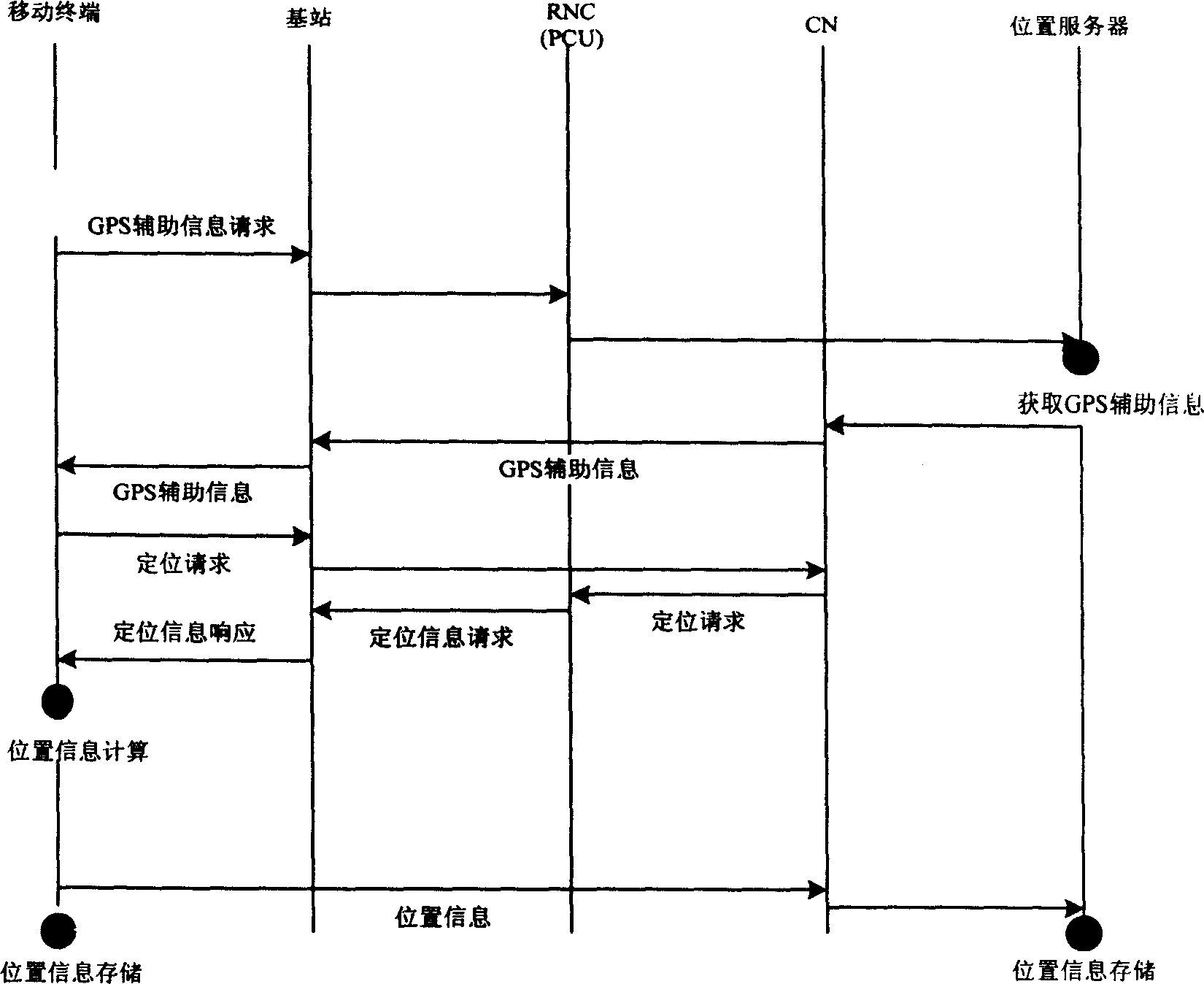

Method for positioning RTK based on TD-SCDMA

InactiveCN1897748AIncrease flexibilityRadio/inductive link selection arrangementsRadio transmission for post communicationQuality of serviceTD-SCDMA

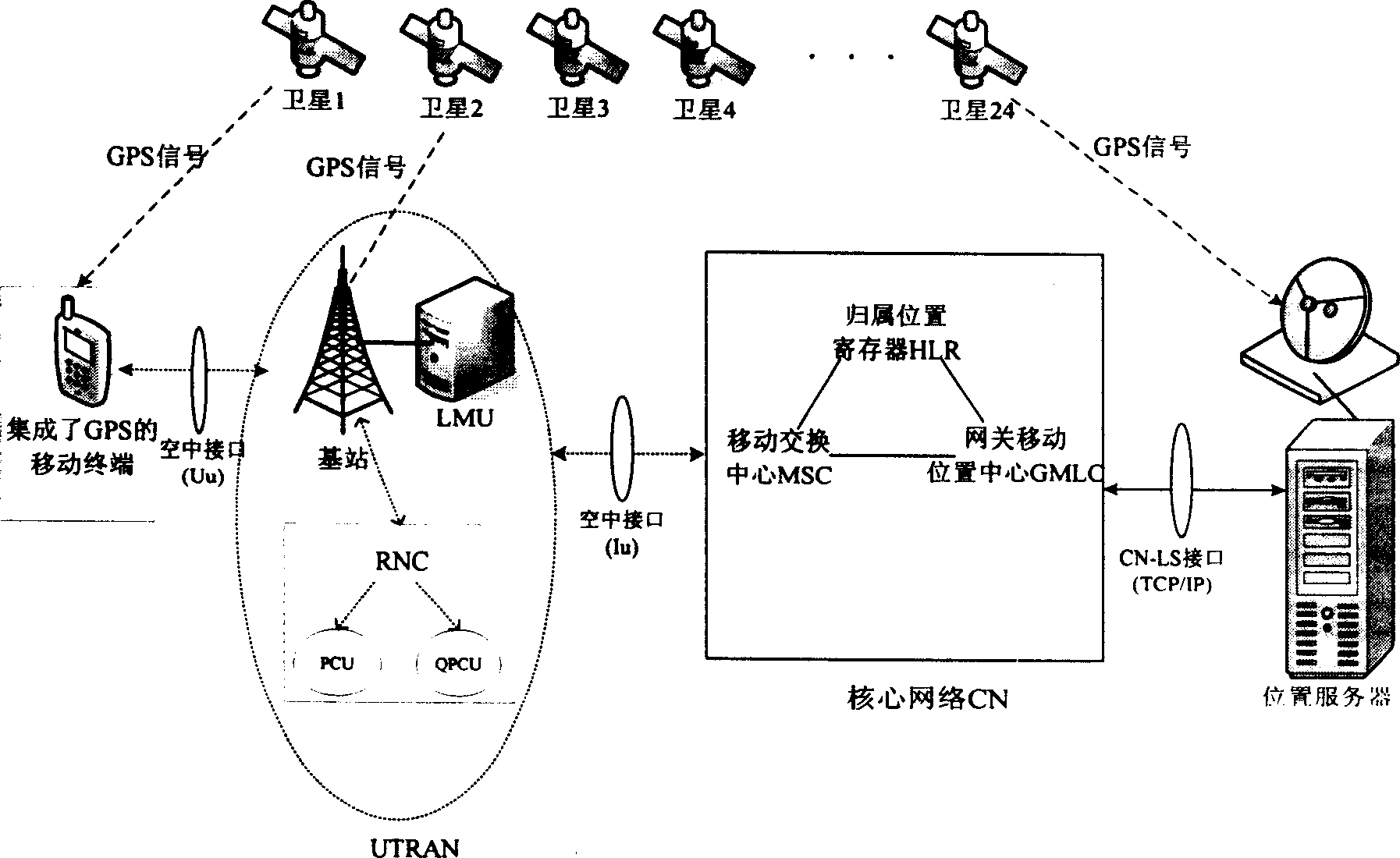

In the positioning service field there is no any service that can meet the positioning request of user at state of high accuracy and high moving speed. The invention embeds both quasi RTK and RTK methods into TD-SCDMA system to design the positioning process, define the relevant communication interface and message and select different algorithm according to the user's QoS requirement to meet the need of positioning request in different accuracy level.

Owner:CHONGQING UNIV OF POSTS & TELECOMM +1

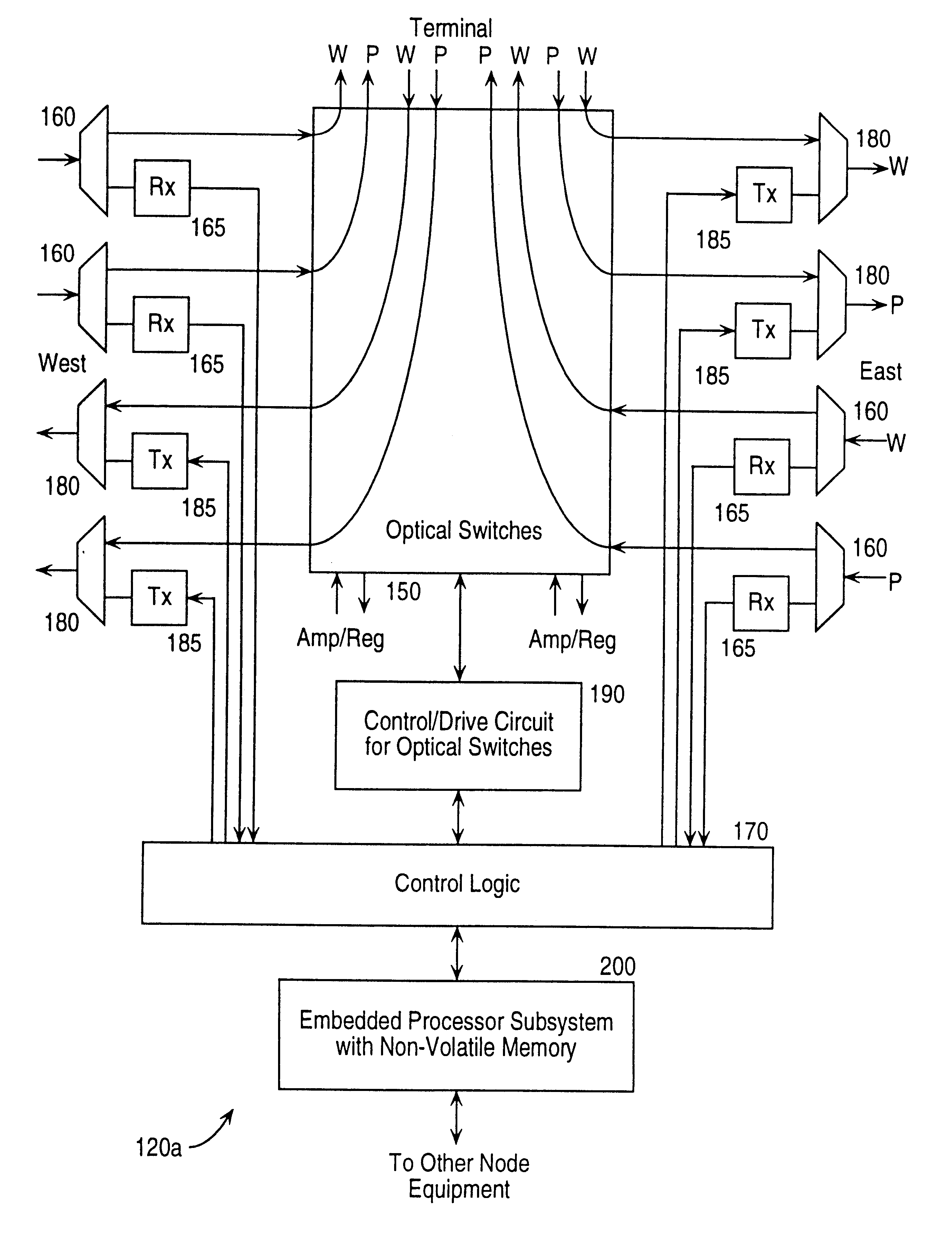

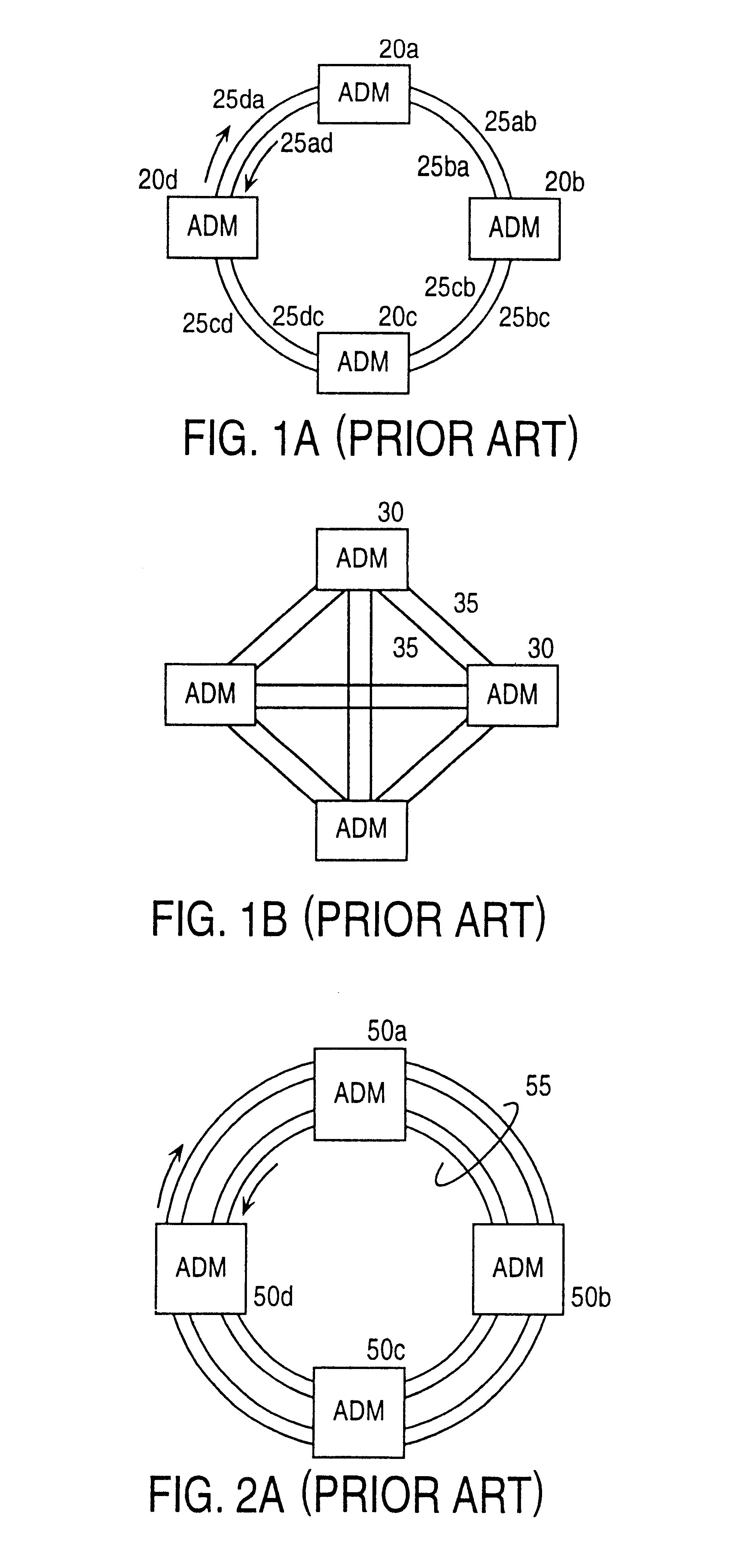

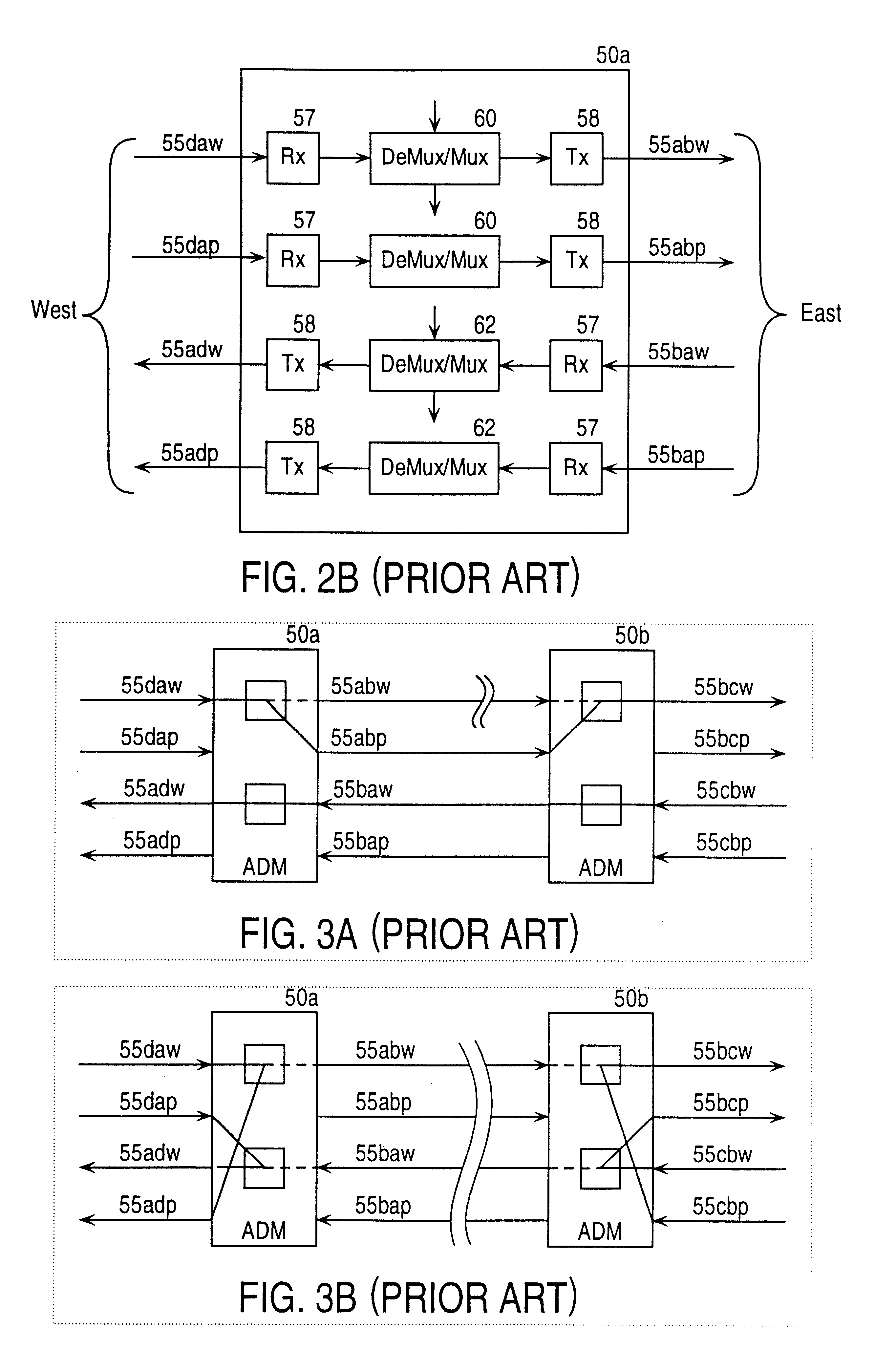

Method and apparatus for operation, protection, and restoration of heterogeneous optical communication networks

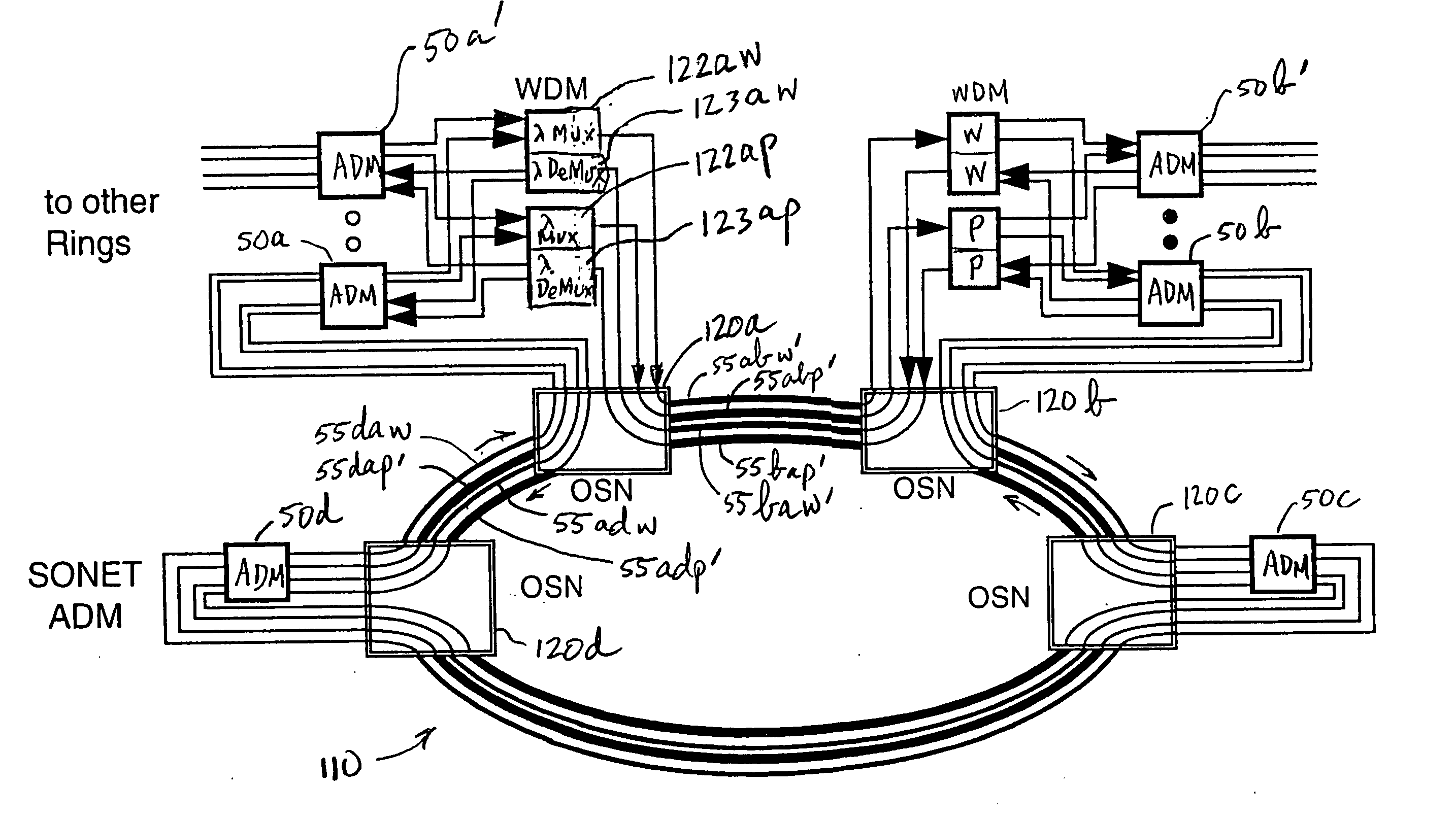

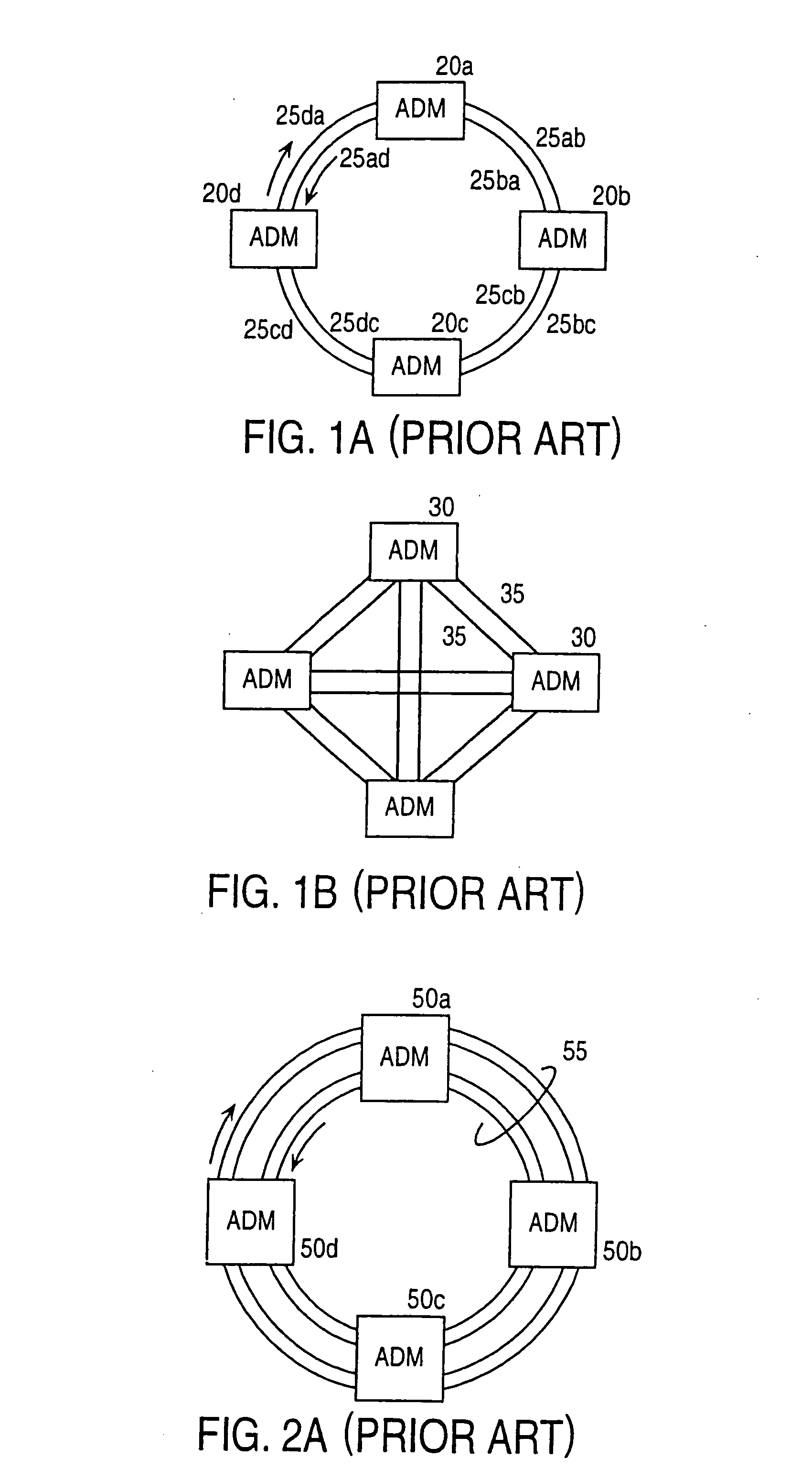

Techniques for providing normal operation and service restoration capability in the event of failure of terminal equipment or transmission media in a heterogeneous network, such as a hybrid network containing single- and multi-wavelength lightwave communications systems. An optical switching node (OSN) is placed at each node in the ring network to provide the required connections between various fibers and terminal equipment, but having switch states that allow signals on the protection fibers to bypass the terminal equipment at that node. Ring-switched signals propagate around the ring on protection fibers without encountering the terminal equipment at the intervening nodes. To the extent that the protection fiber links between any given pair of nodes are incapable of supporting all the relevant communication regimes, such links are modified to provide such support.

Owner:CIENA

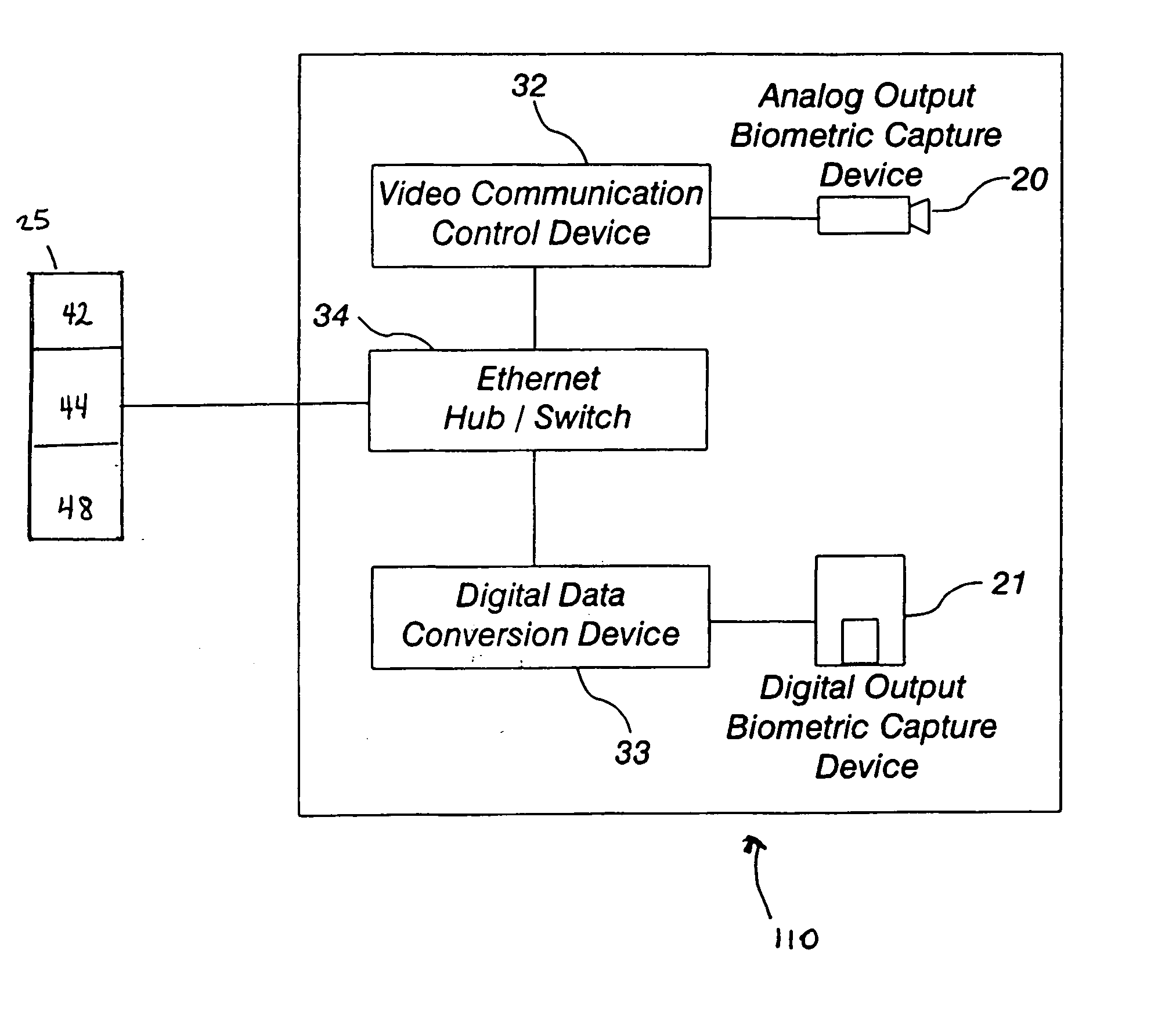

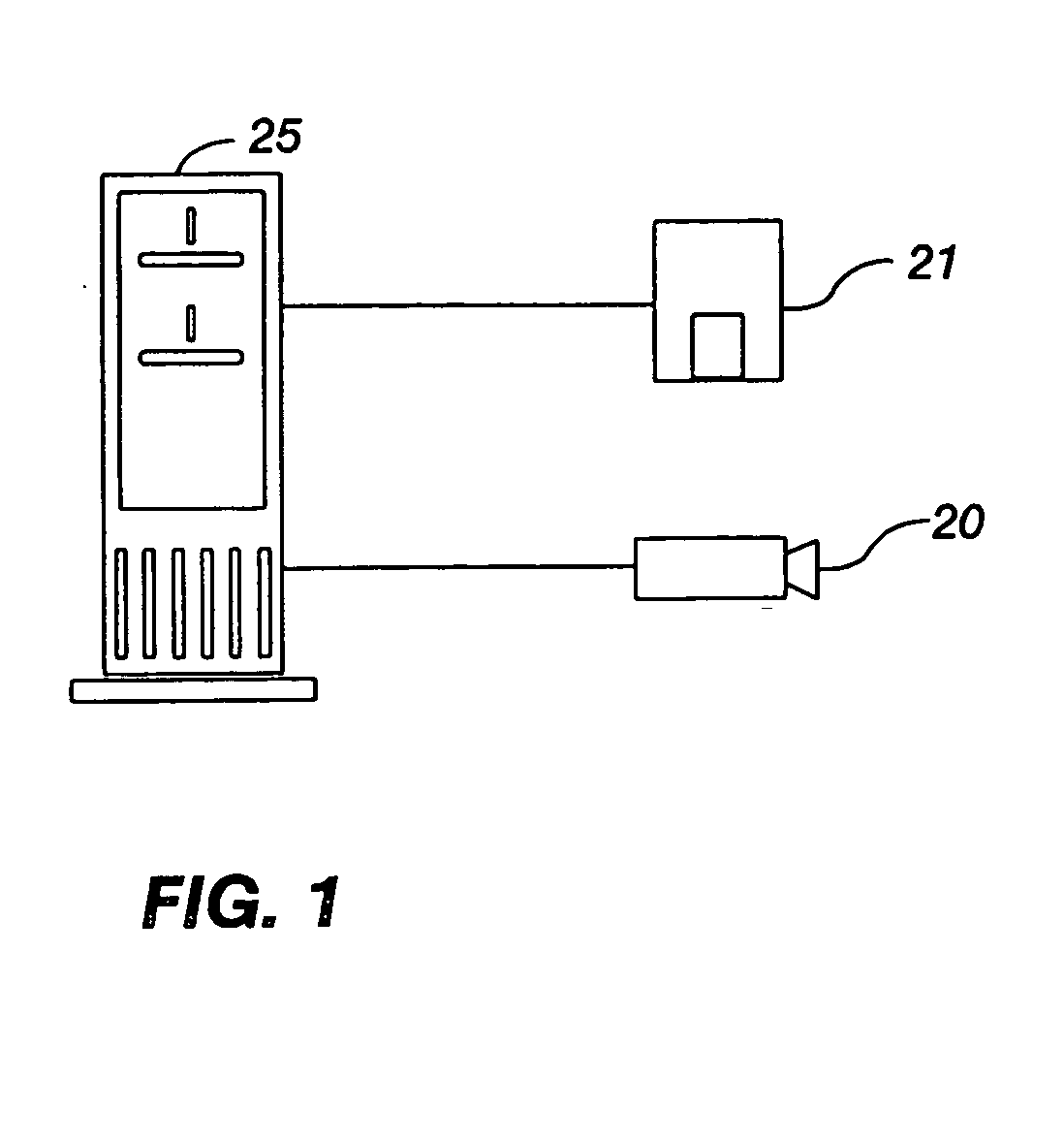

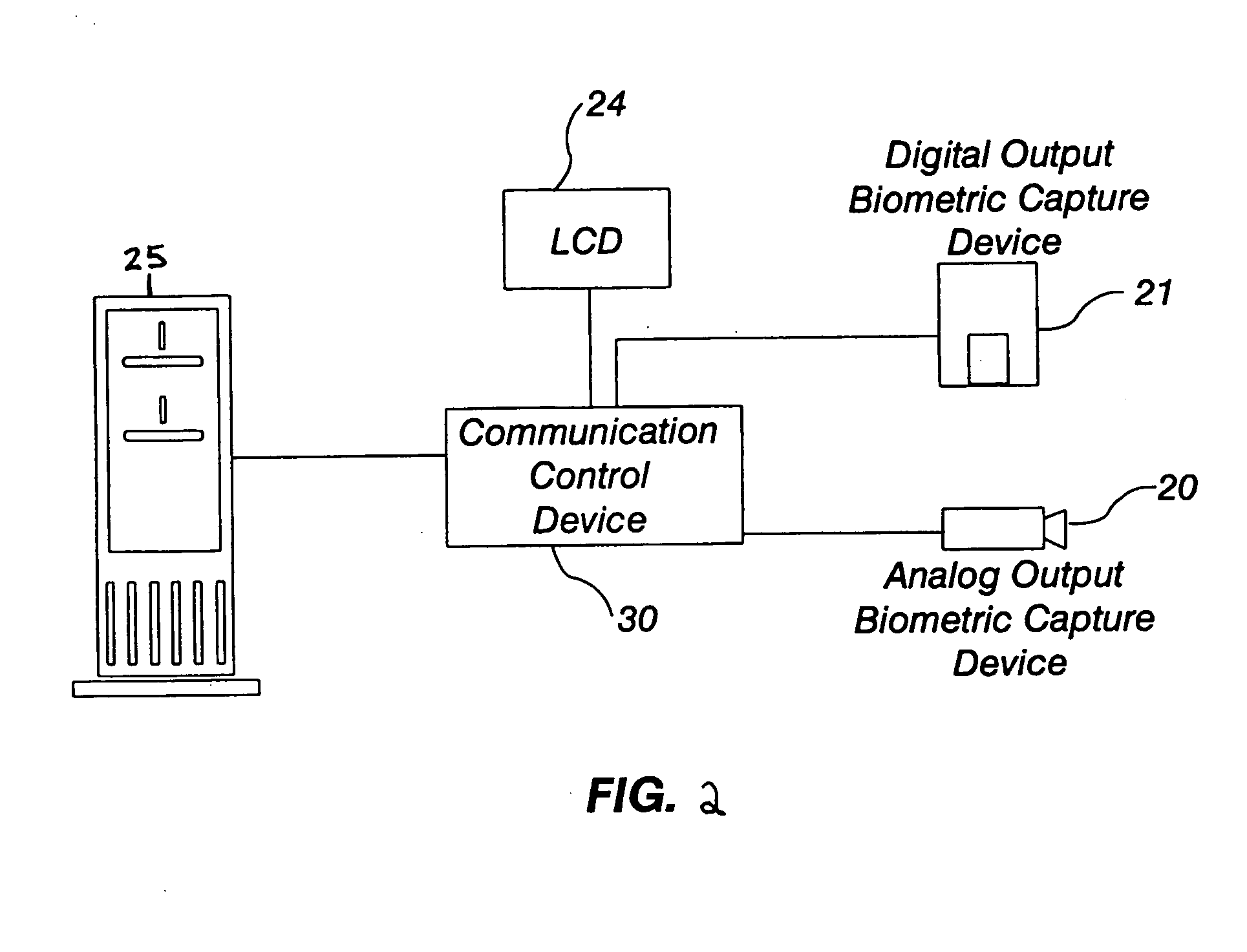

Identity verification system with interoperable and interchangeable input devices

InactiveUS20050084139A1Improve trustBiometric pattern recognitionIndividual entry/exit registersDigital dataSoftware system

The present invention is an interoperable biometrics system that utilizes one or more video communication control devices 32 and / or one or more digital data conversion devices 33 to allow multiple analogue 20 and / or digital 21 output biometric capture devices to communicate with a processing computer 25. The system further incorporates a routing software for addressing and naming the various hardware devices and software systems to enable interoperability between different makes and models and the biometrics capture and / or processing devices, their relevant communications software, and their relevant processing software and algorithms.

Owner:BIOCOM

System and method for relevant business networking based in controlled relevancy groups, responsilibites and measured performance

ActiveUS20130041952A1Meaningful and relevant business connectionReduce inhibitionMultiple digital computer combinationsOffice automationRelevant informationRelevant Communications

A business networking system and method for groups of people within a variety of business types to organize themselves into specific and relevant categories in order to maximize the exchange of relevant information and further development of relevant business contacts. The method and system offer tools for registering members and sub-dividing those registered members into smaller relevant groups. The method matches members of similar backgrounds and business experiences and provides communications, messaging and meetings for relevant. The system provides tools to encourage reciprocal relevant communications, both online and in the real world, between members. All activity is tracked and grouped into a plurality of statistics that are then ranked and shared with members. The statistics are used by the TBS system as a scorecard or as punishment in the form of expulsion from the categorized group.

Owner:BOARDSEAT

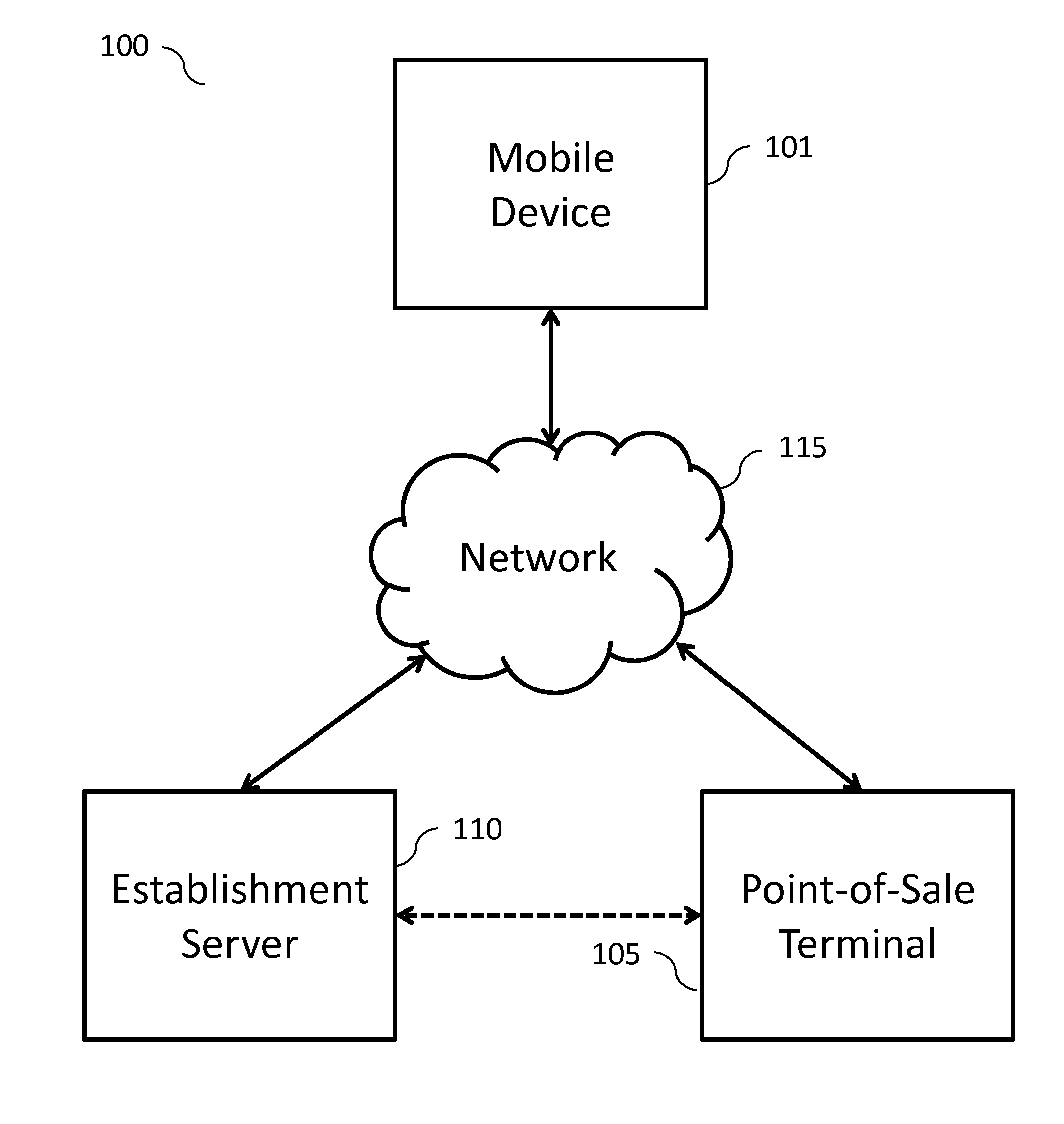

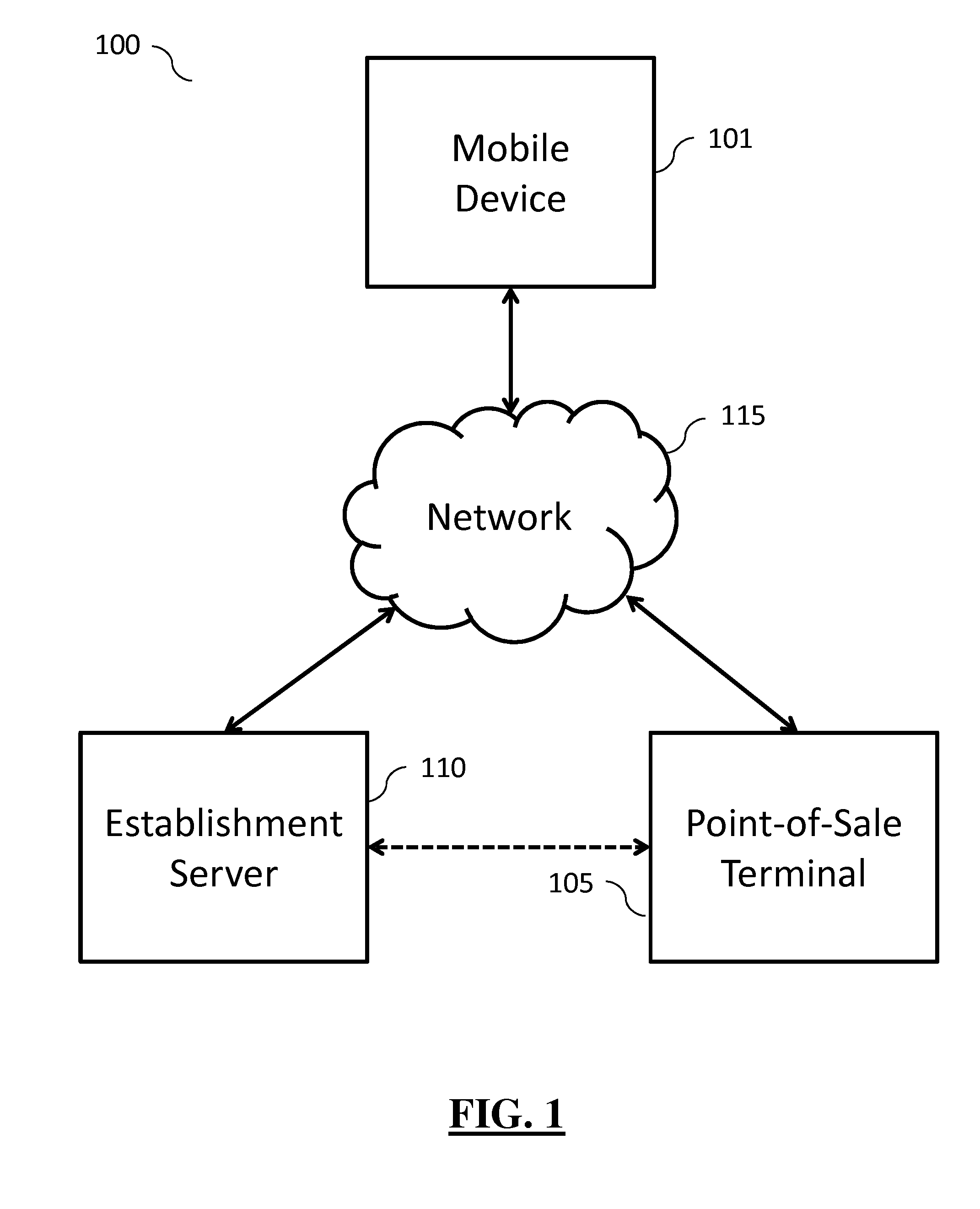

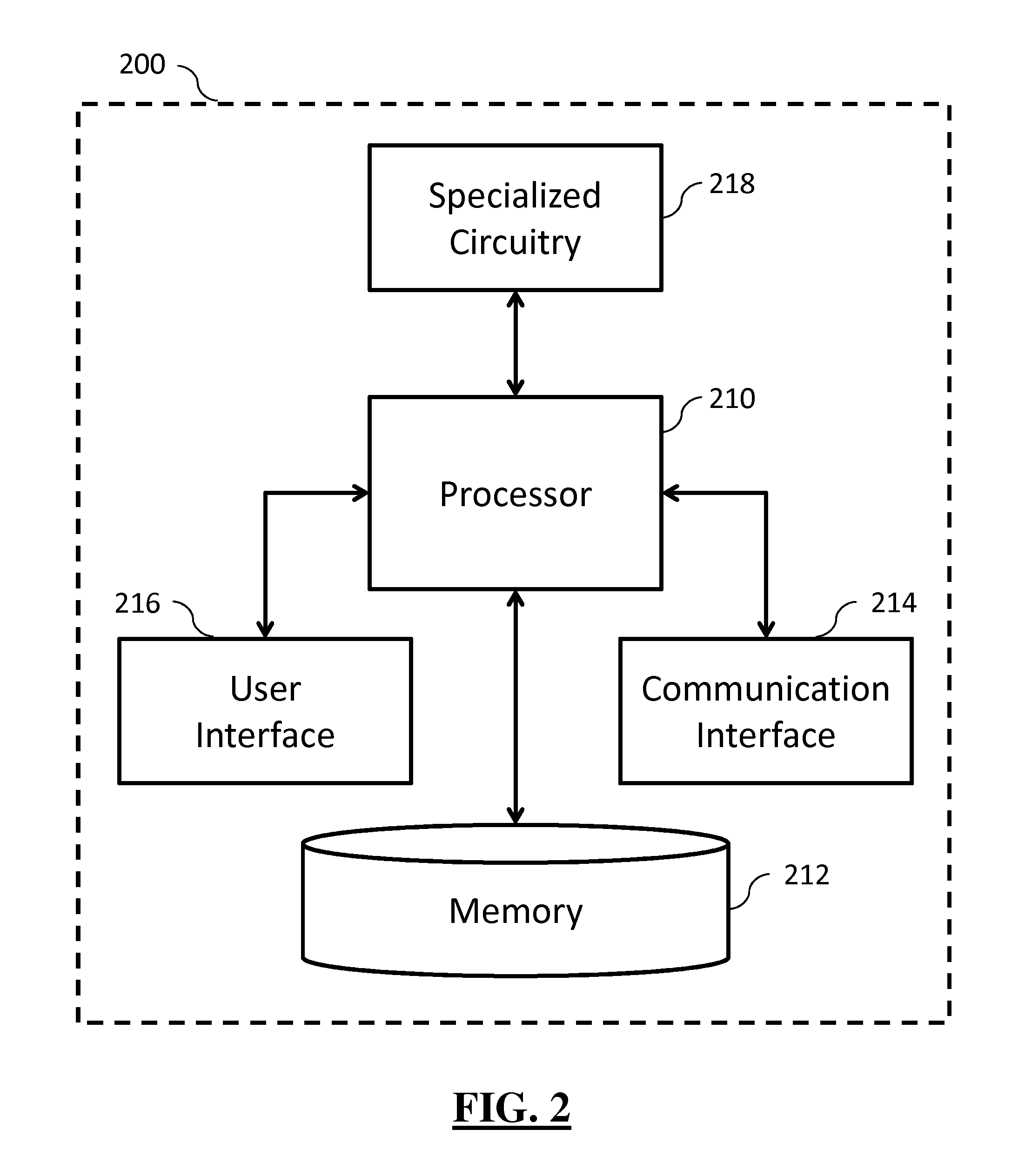

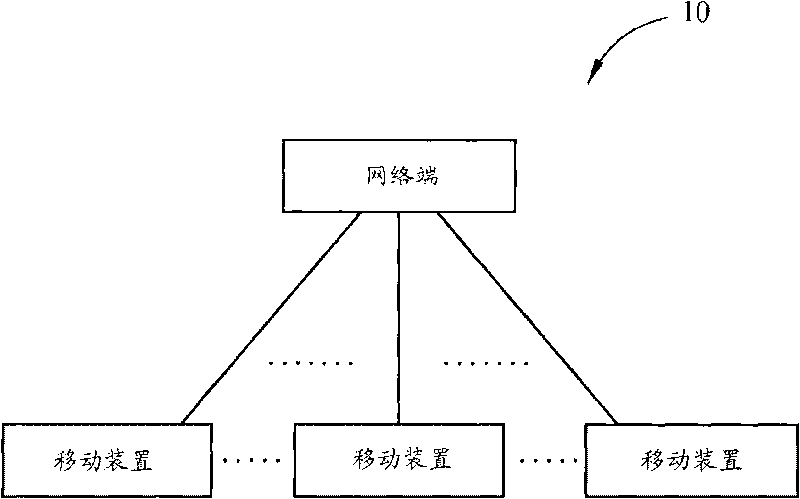

Systems and methods for facilitating location-relevant communication

Various methods are described for tracking the location of a customer possessing a mobile device and facilitating location-relevant communication between the mobile device and an establishment device. One example method may comprise detecting the presence of the customer within a first distance of an establishment. The method may further comprise receiving establishment information from the establishment entity for displaying to the customer to entice a visit to the establishment. Additionally, the method may comprise detecting the presence of the customer within a second distance of a location point within the establishment. Another example method may further comprise determining location information relevant to the location point; and providing for display of the location information to the customer. Similar and related methods, apparatuses, and computer program products are also provided.

Owner:NCR CORP

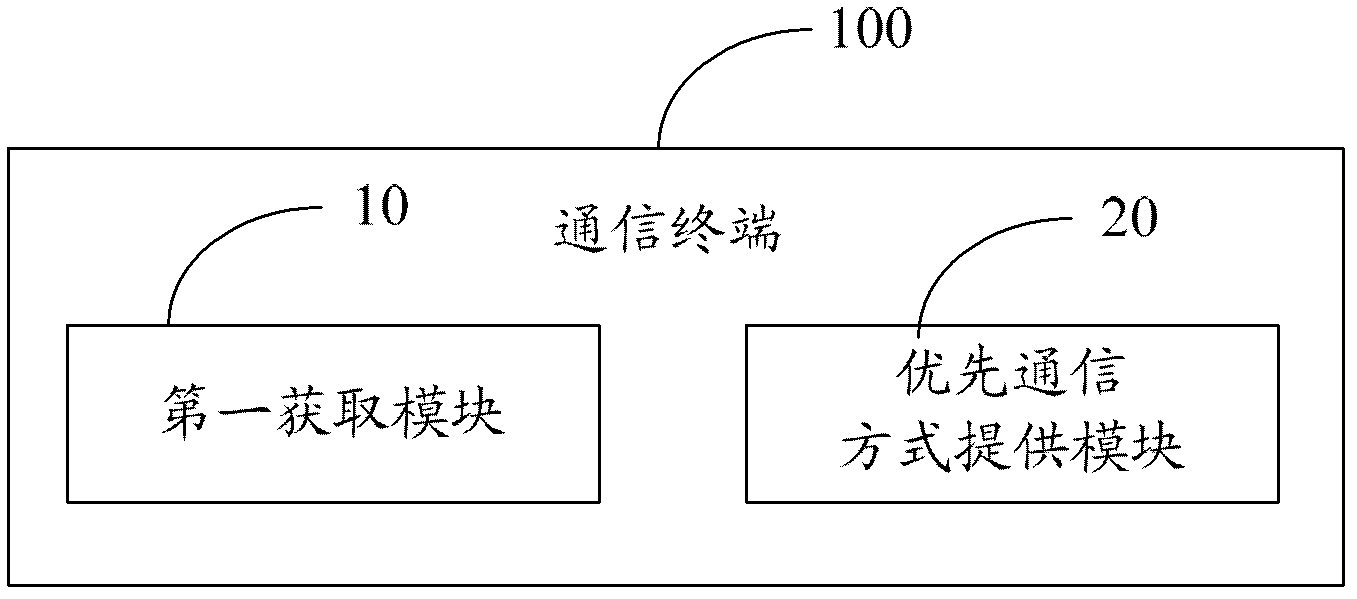

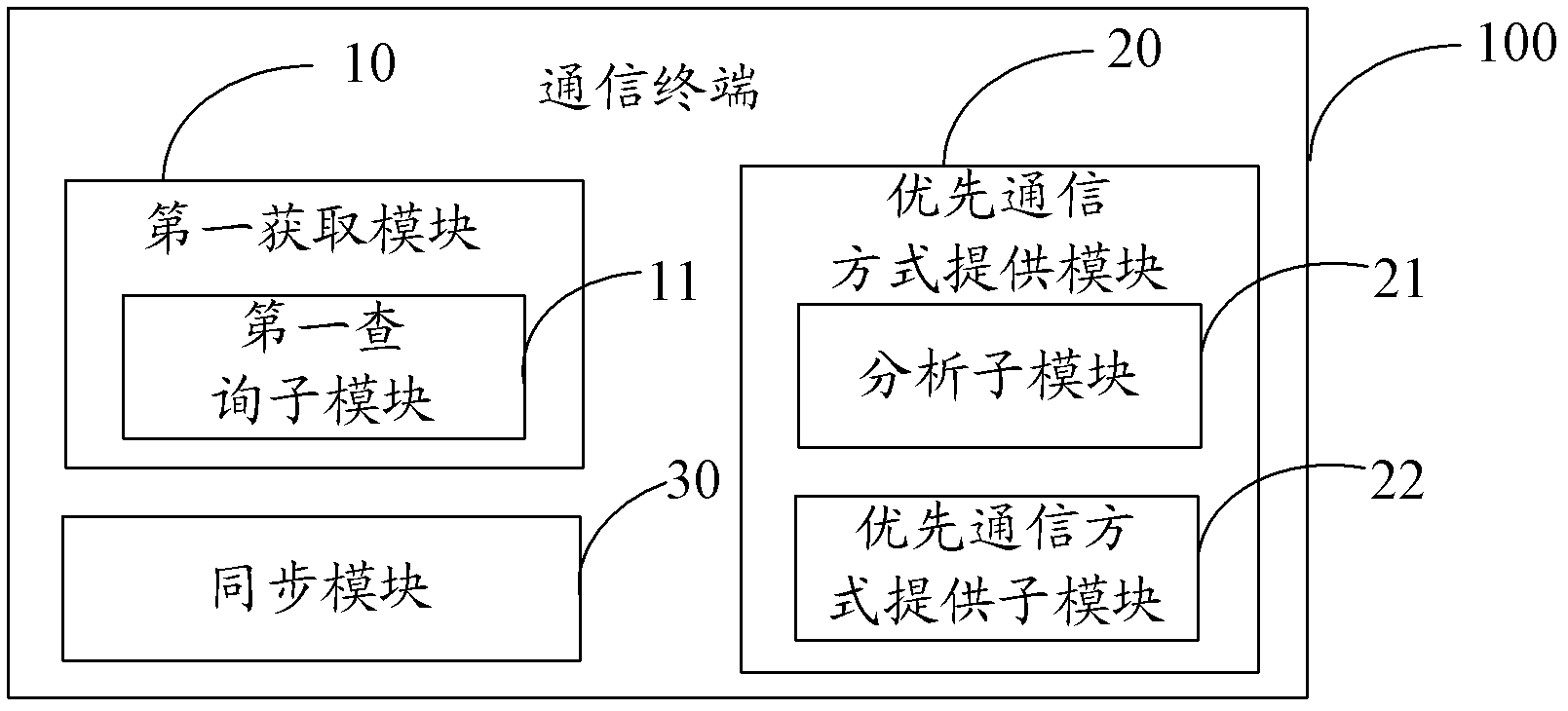

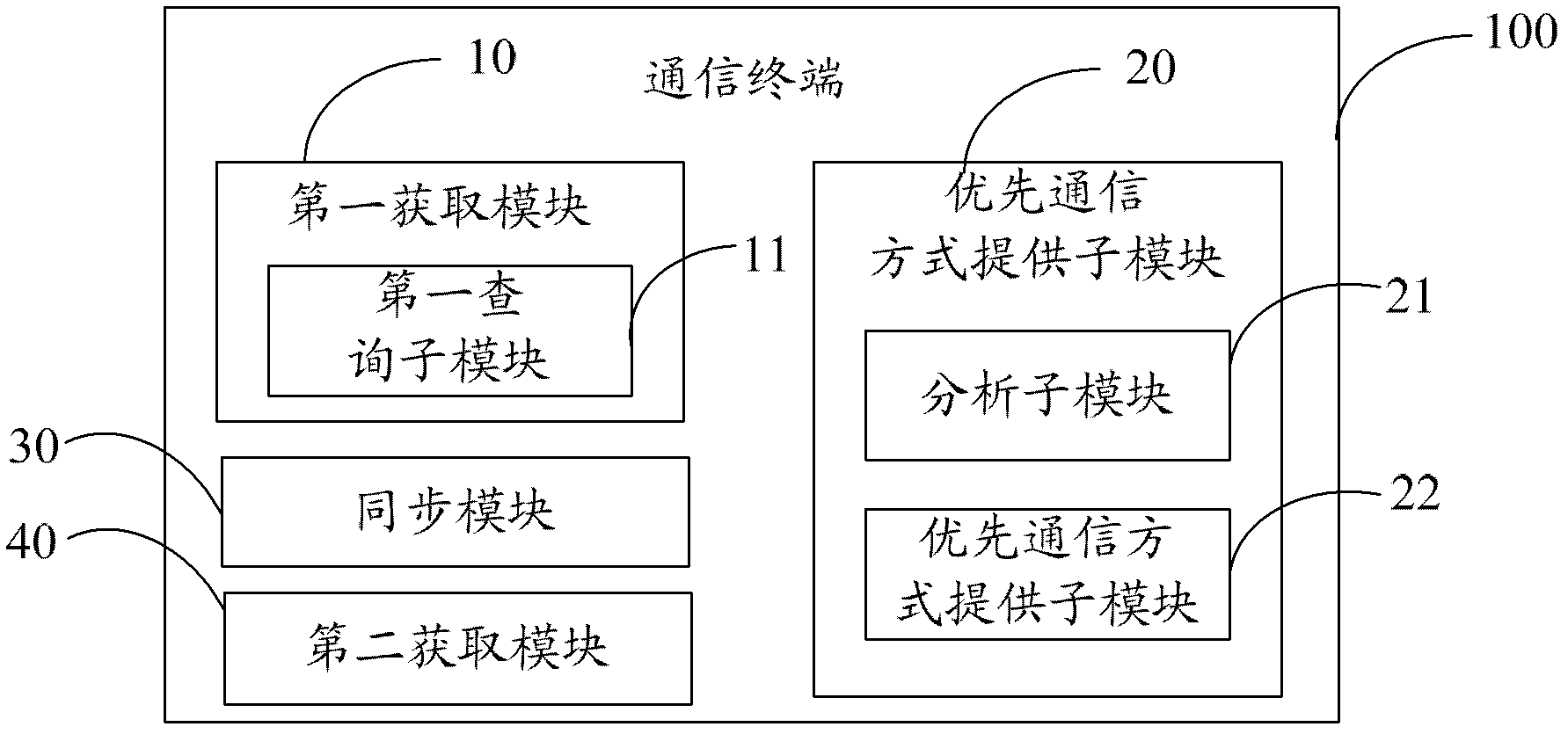

Method of selecting communication modes and communication terminal of same

ActiveCN103259820AFacilitate communicationImprove handlingMessaging/mailboxes/announcementsTransmissionRelevant CommunicationsComputer science

The invention belongs to the technical field of communication, and provides a method of selecting communication modes and a communication terminal of the method. The method comprises the following steps: the current state of a called terminal and a relevant communication account number of the called terminal are acquired, and a preferential communication mode of contacting the called terminal is provided for a user according to the current state of the called terminal and the relevant communication account number of the called terminal. Therefore, the method of selecting the communication modes and the communication terminal of the method provide the user with the preferential communication mode of contacting the called terminal.

Owner:YULONG COMPUTER TELECOMM SCI (SHENZHEN) CO LTD

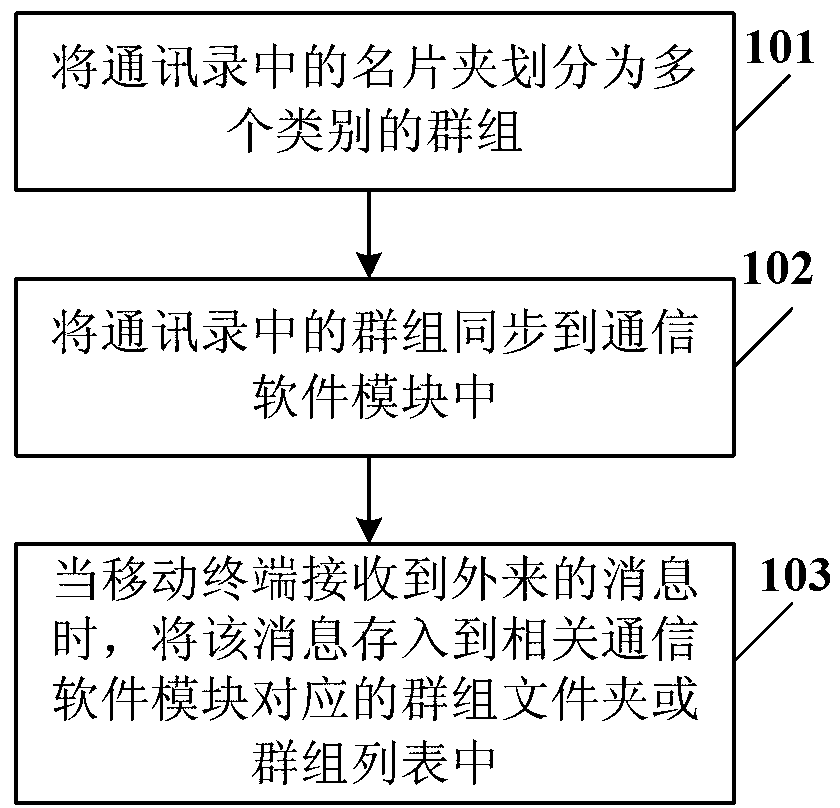

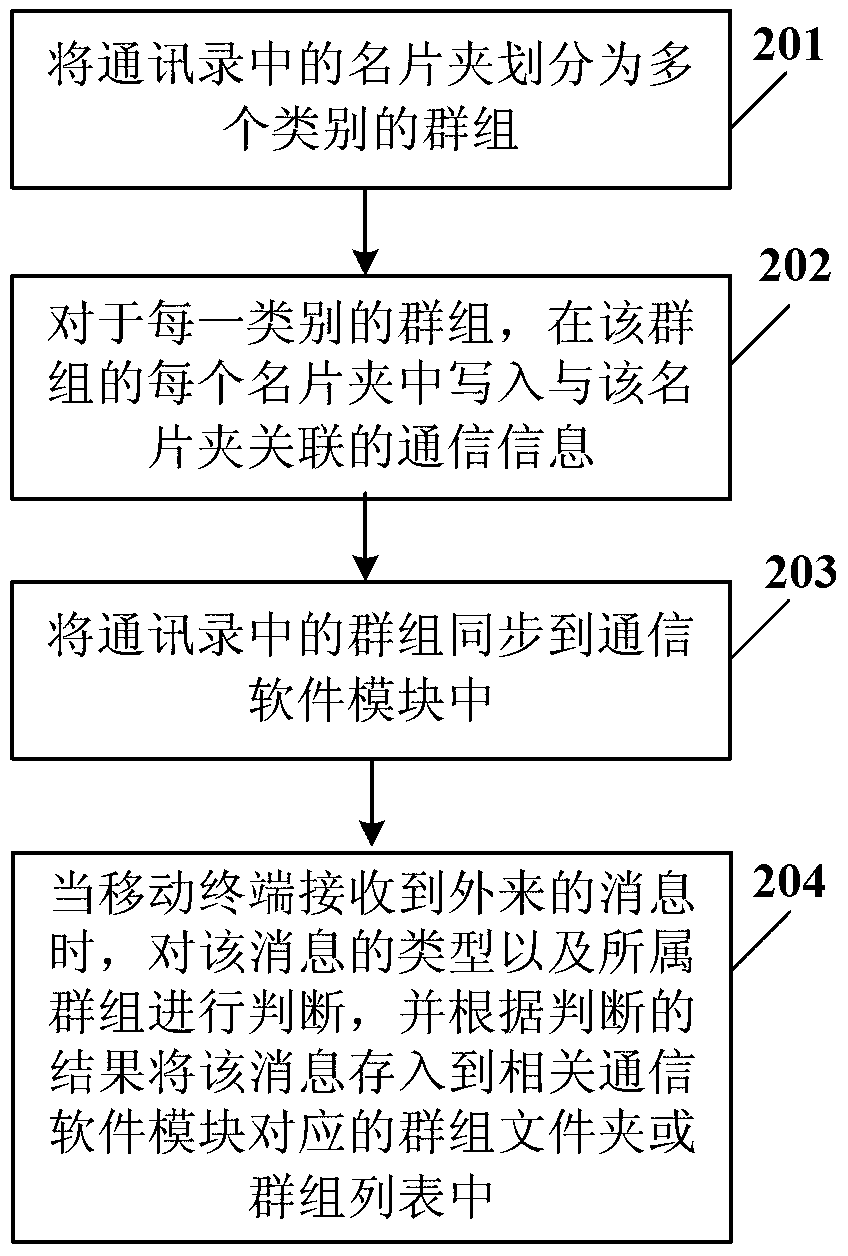

Address book based automatic sorting method and device and mobile terminal

InactiveCN103024175AConvenience to workHigh activitySubstation equipmentMessaging/mailboxes/announcementsAddress bookCommunications software

The invention discloses an address book based automatic sorting method and a device and a mobile terminal. The method mainly includes dividing name card folders in an address book into a plurality of classified groups, synchronizing the groups in the address book to a communication software module; and when the mobile terminal receives an external message, storing the message to a group file folder or a group list which corresponds to the relevant communication software module. According to the address book based automatic sorting method and the device and the mobile terminal, by means of the name card folders edited by a user, corresponding groups are divided, and the message can automatically enter into the corresponding group file folder or the group list when the message is received so that required messages can be rapidly searched, efficiencies are greatly improved, and work and life of the user are facilitated.

Owner:ZTE CORP

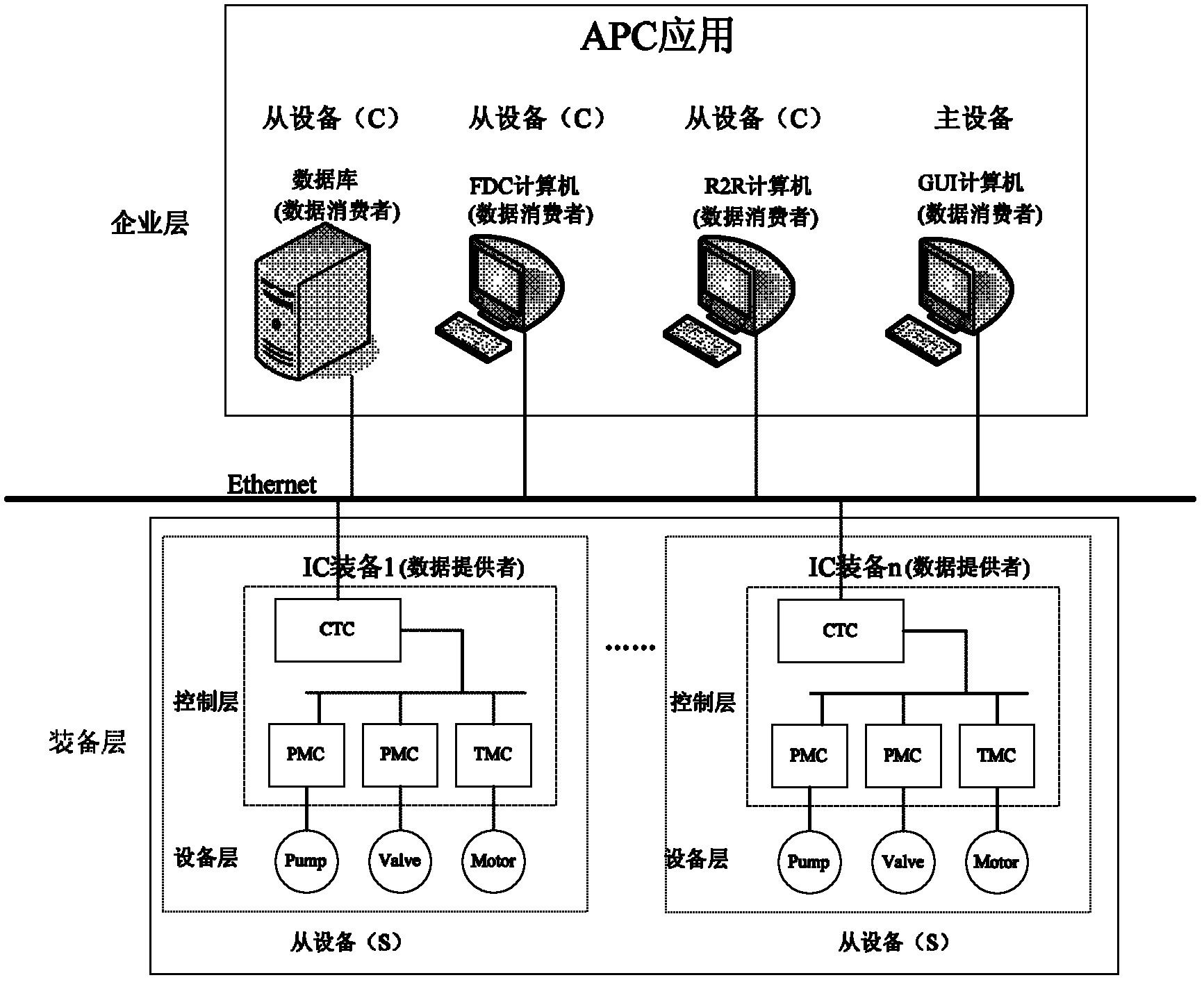

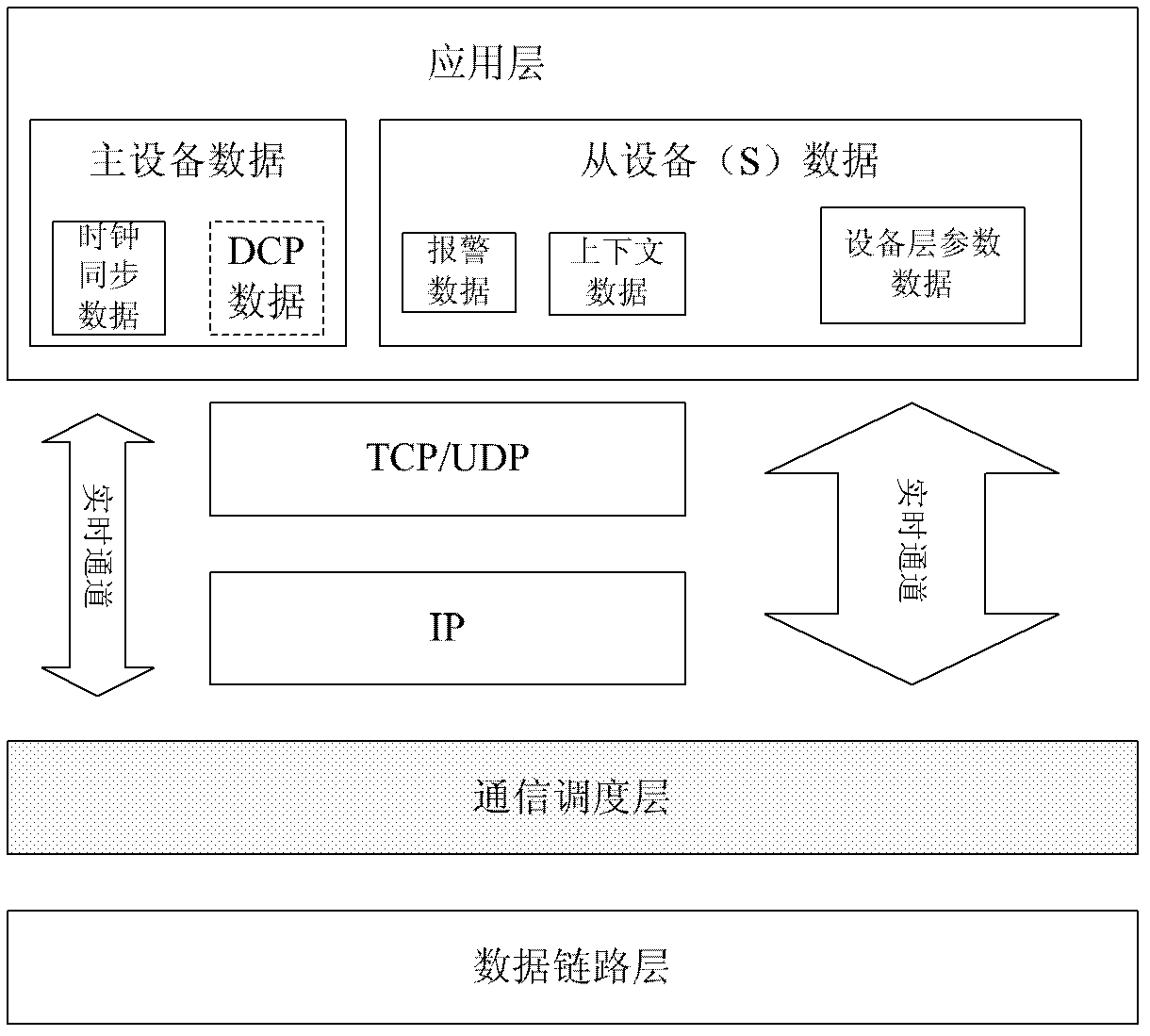

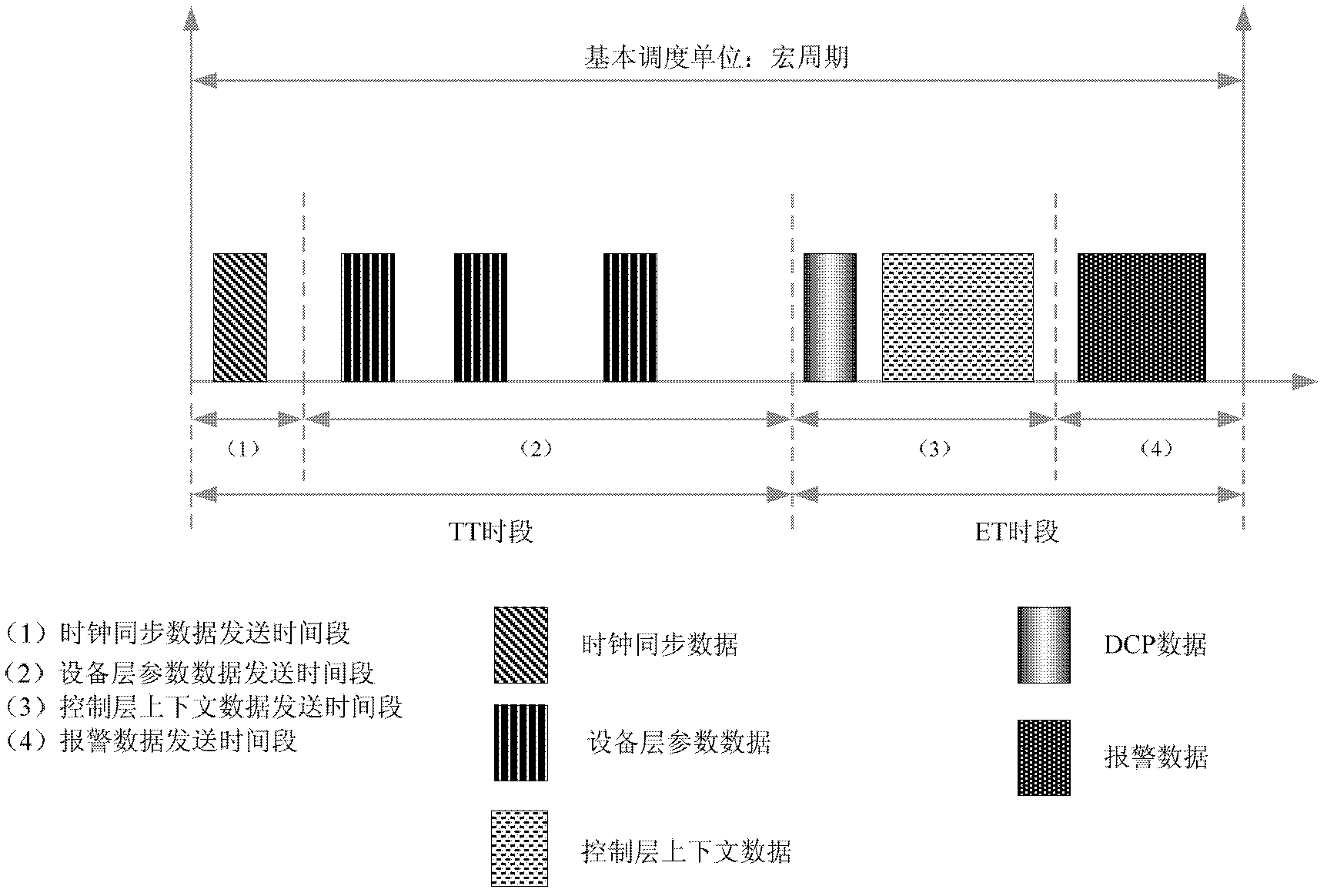

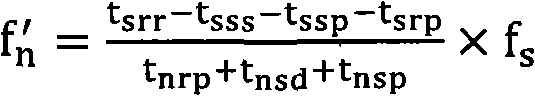

Ethernet deterministic data transmission method of data-oriented role

ActiveCN102843390AMeet data access requirementsGive full play to the advantagesData switching networksEvent triggerRelevant Communications

The invention provides an Ethernet deterministic data transmission method of a data-oriented role, and meets the requirements of advance process control (APC) application for collecting internal data of IC (Integrated Circuit) equipment. The method comprises the following steps: adding a communication scheduling layer between an Ethernet data link layer and a network layer; adding a real-time channel; acquiring the maximum common divisor of period values according to data of each data tracking request in a data acquiring plan to determine a macro cycle value; and dividing the macro cycle into four time ranges in a time axis according to a four-part form dividing principle, and determining transmitting modes of messages based on the characteristics of the various messages ; carrying out the bus arbitration in a way that the time triggering and event triggering are combined; and keeping time consistency of all sub-equipment in the system and the main equipment based on a clock synchronization algorithm. With the adoption of the method provided by the invention, relevant communication scheduling methods are provided to the data which have the different requirements on transmitting time limitation according to the specific characteristics of various data in the IC equipment, and the requirements of the APC application to the data access of the equipment can be met well.

Owner:SHENYANG INST OF AUTOMATION - CHINESE ACAD OF SCI

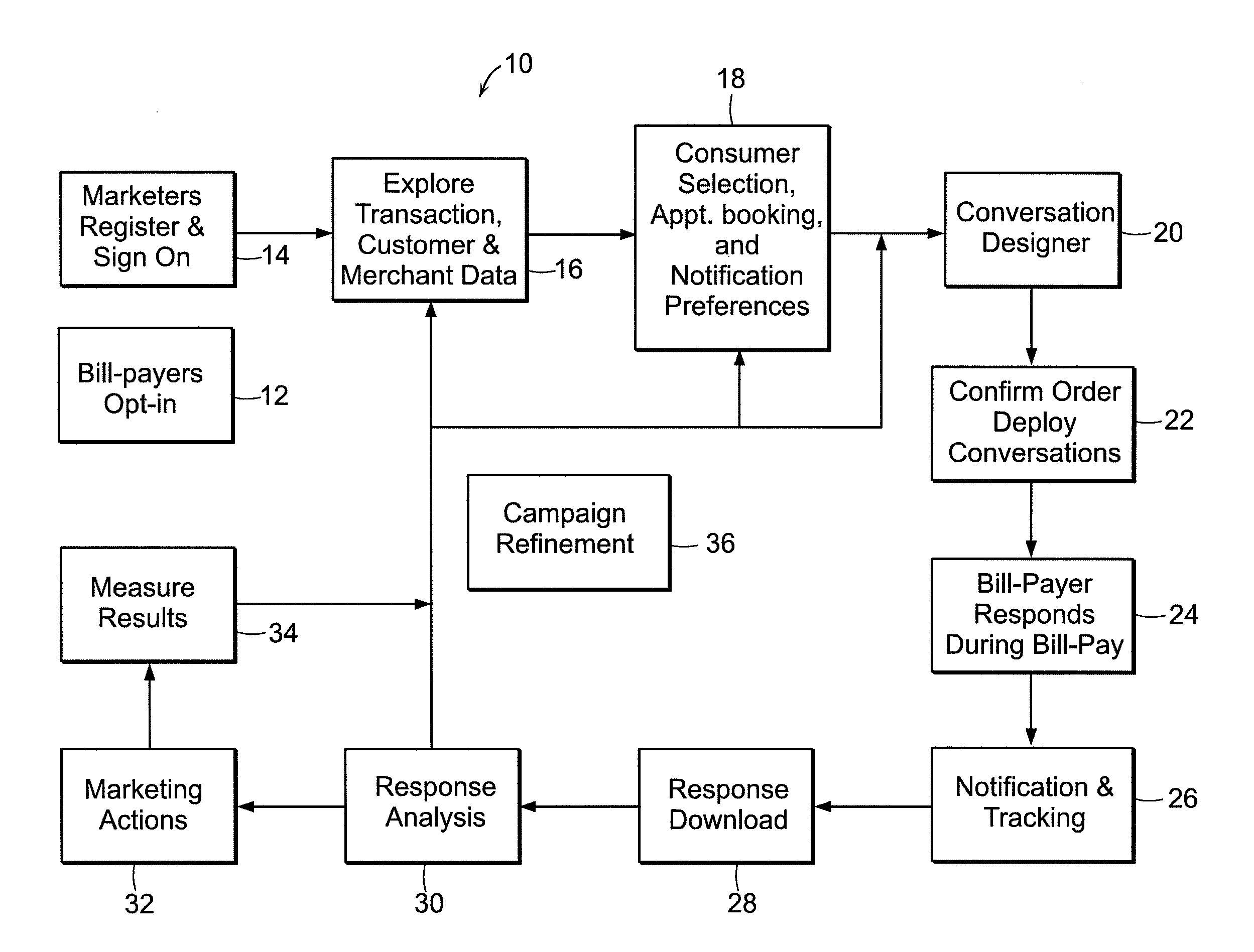

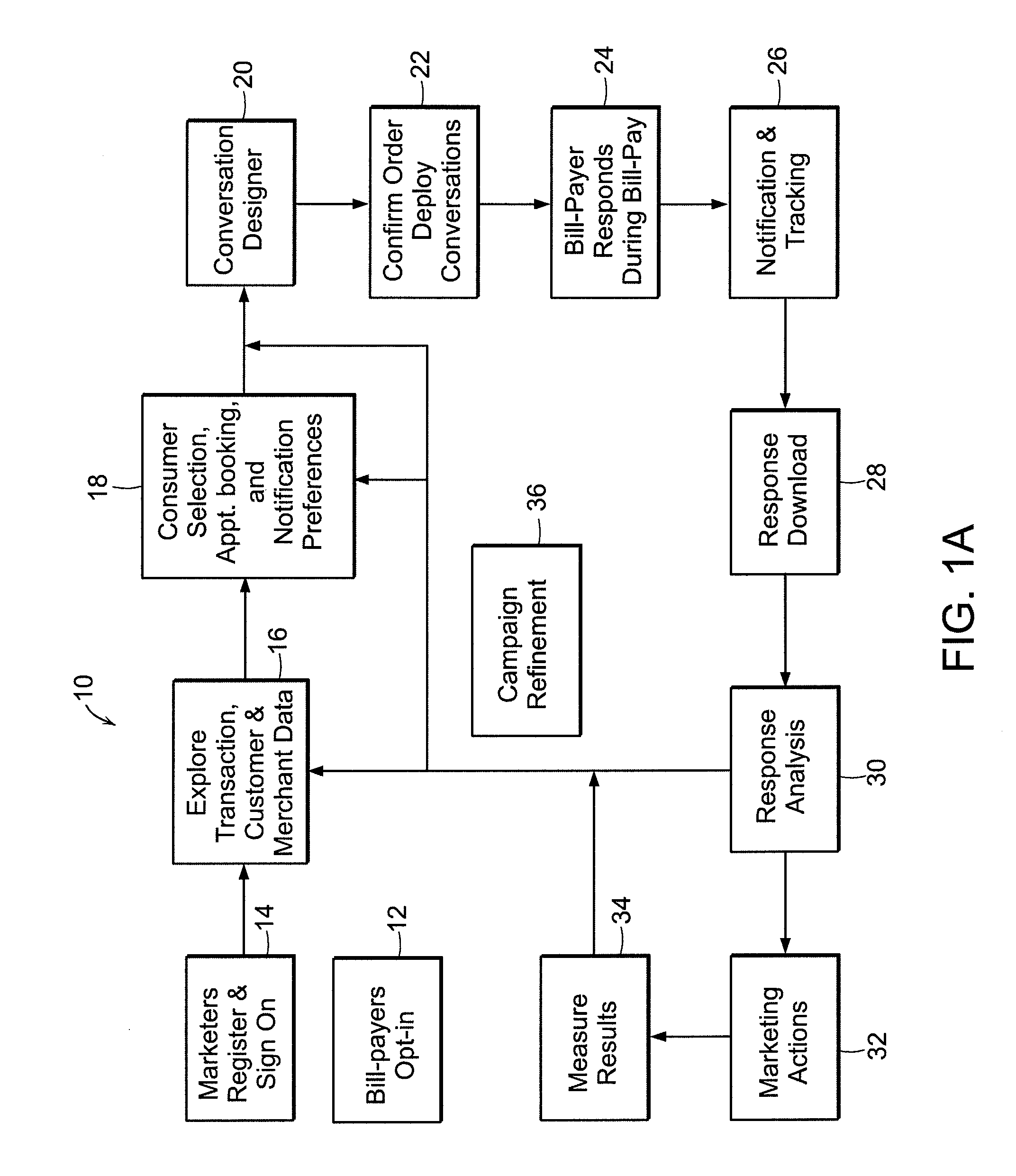

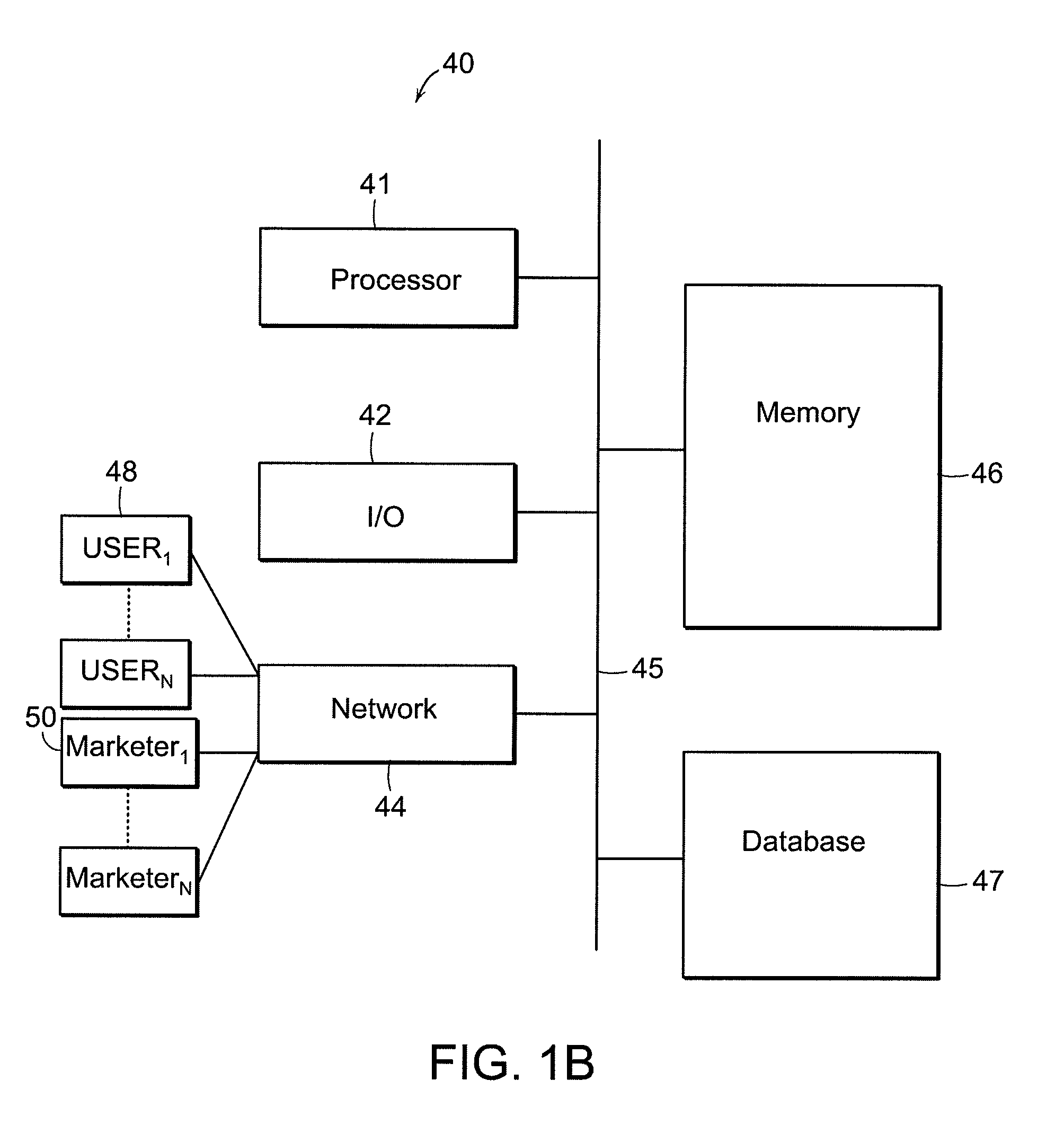

Interactive marketing system

PendingUS20090240567A1Lowered debt costImproved credit scoreMarket predictionsFinancePaymentRelevant Communications

The present invention is a system which enables a marketing team to initiate and sustain directed and interactive communication with thousands or millions of existing or prospective customers. In the preferred embodiment, a marketer accesses a database and selects a group of qualified prospects, using lifestyle dimensions and or demographic information, from a stable group of prospective or existing customers conducting financial transactions online. Once a prospect list is selected, the marketer designs a series of questions, typically using branch and skip logic, and the system deploys the question sequence to the target list in the form of a response-redeemable savings coupon. When prospects are next performing their financial transactions online, they are presented with a lifestyle-relevant coupon which is immediately redeemable by responding to the question / communication, therewith lowering the respondent's bill instantaneously upon response, as in the case of online bill payment. Reponses are made available to the marketer who can use this information to further segment and qualify respondents. The marketer can then initiate a new, more relevant line of inquiry, based on previous responses, with a more highly qualified subset of prospects. By repeating an ever more relevant communication process with an increasingly qualified prospect group, which ultimately may result in a welcomed invitation to purchase a product or service (e.g. in the form of a coupon redeemable with product or service purchase), both marketer and consumer engage in an interactive relationship. The present invention can use systems and methods for the payment of debts. A communications network can be used by debtors to acquire and transfer funds, securities or any other transferable instrument that increases in value with time to satisfy the debt.

Owner:MICRONOTES

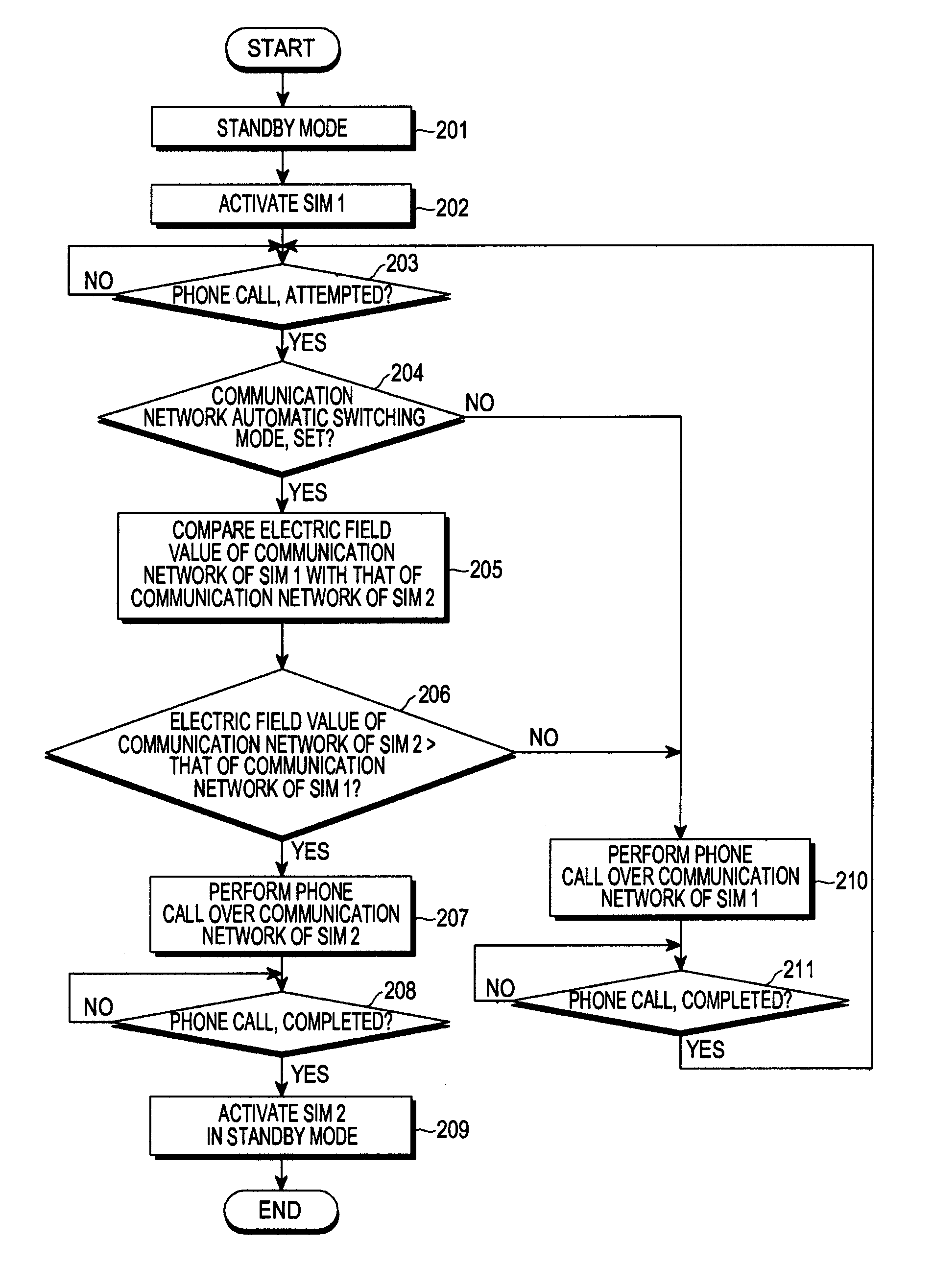

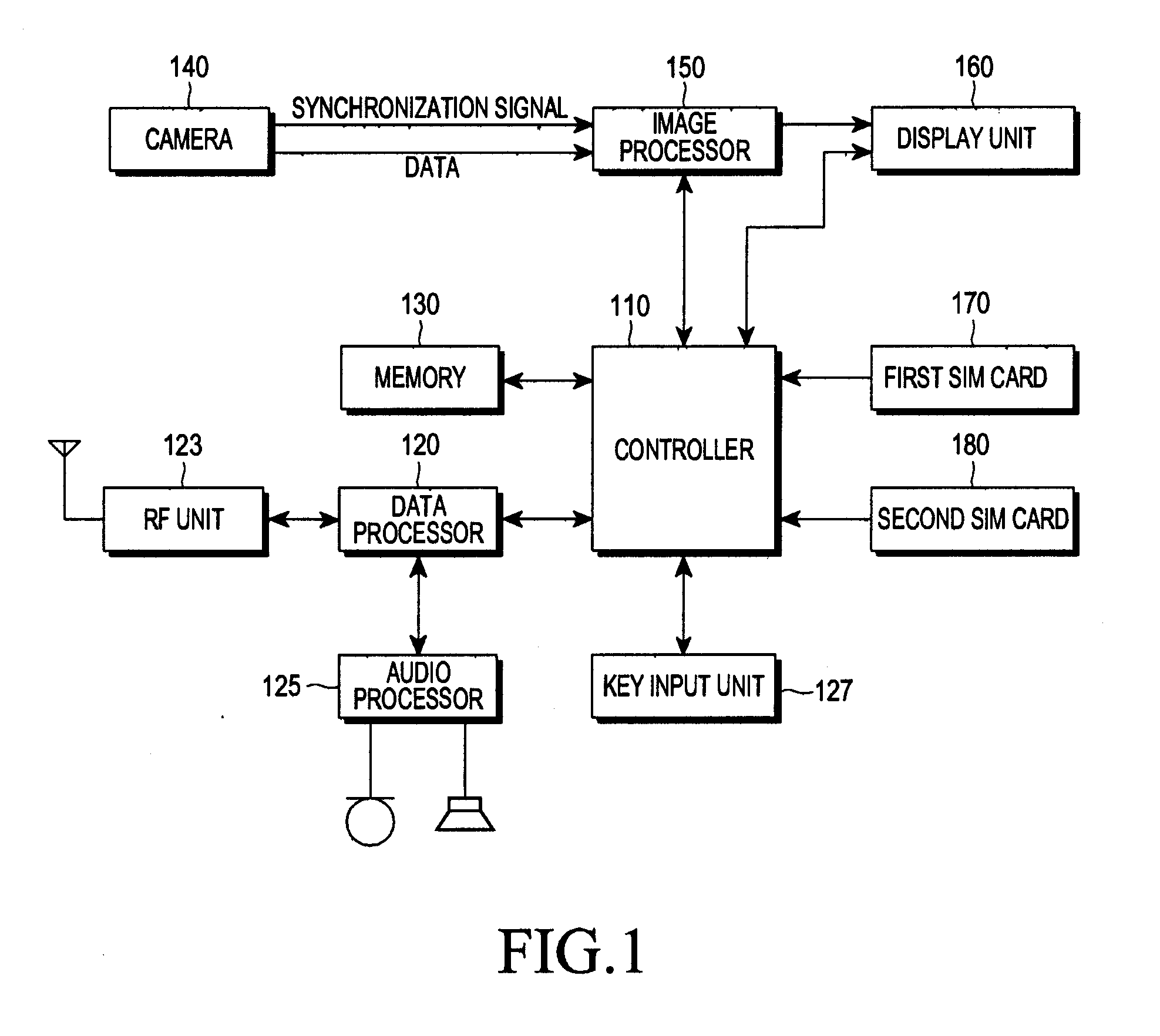

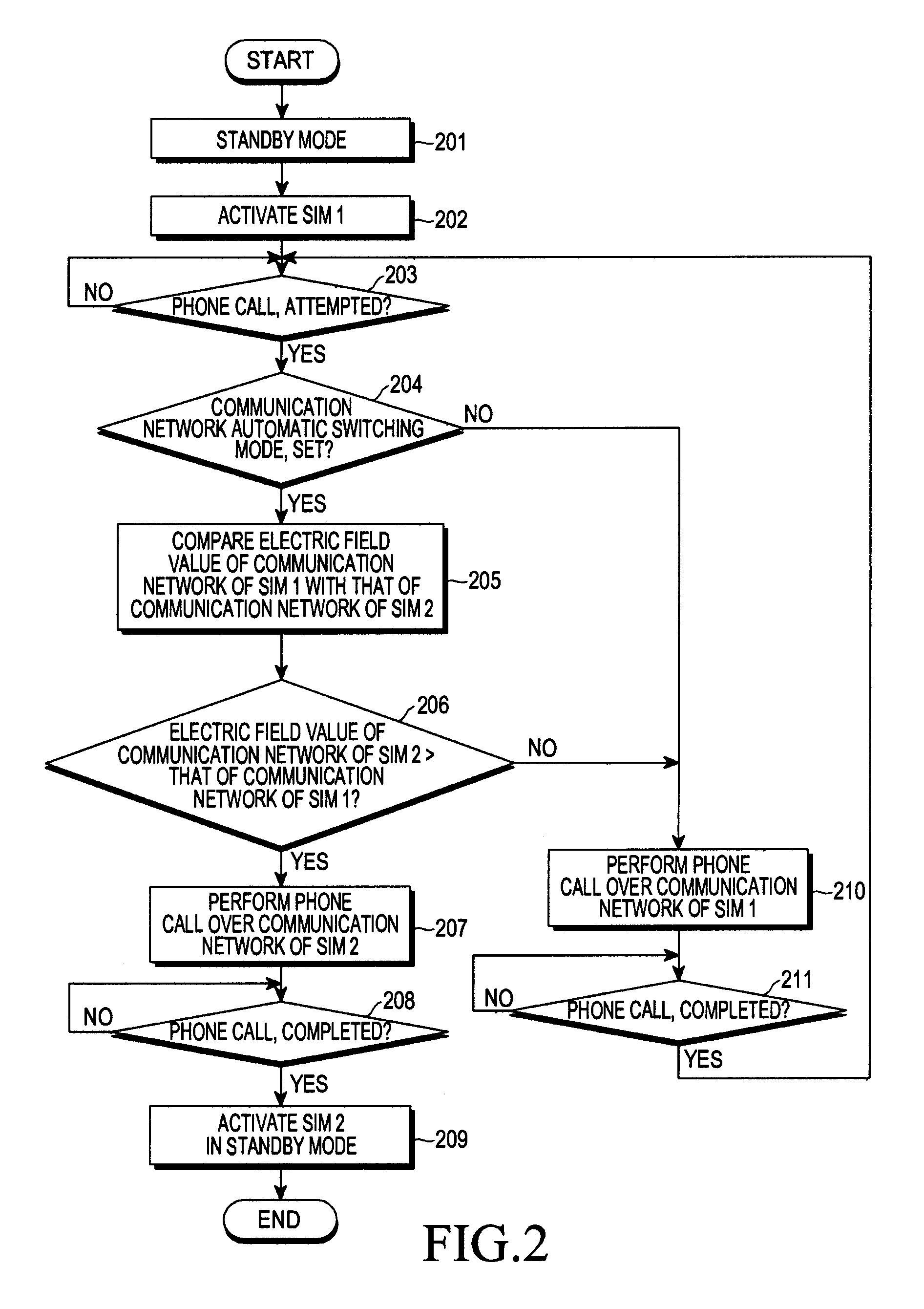

Apparatus and method for performing a call connection in portable terminal

InactiveUS20130053010A1Reduce battery consumptionPower managementAssess restrictionComputer moduleRelevant Communications

The present disclosure relates to an apparatus and a method for performing a call connection in a portable terminal, by which it is possible to reduce the consumption of a battery of the portable terminal when a call connection is performed by the portable terminal including one RF unit and at least two SIM cards. The apparatus includes: at least two Subscriber Identity Module (SIM) cards; and a controller for performing a control operation so as to perform a call connection over a relevant communication network of a SIM card among the at least two SIM cards, which has the larger electric field value of the relevant communication network.

Owner:SAMSUNG ELECTRONICS CO LTD

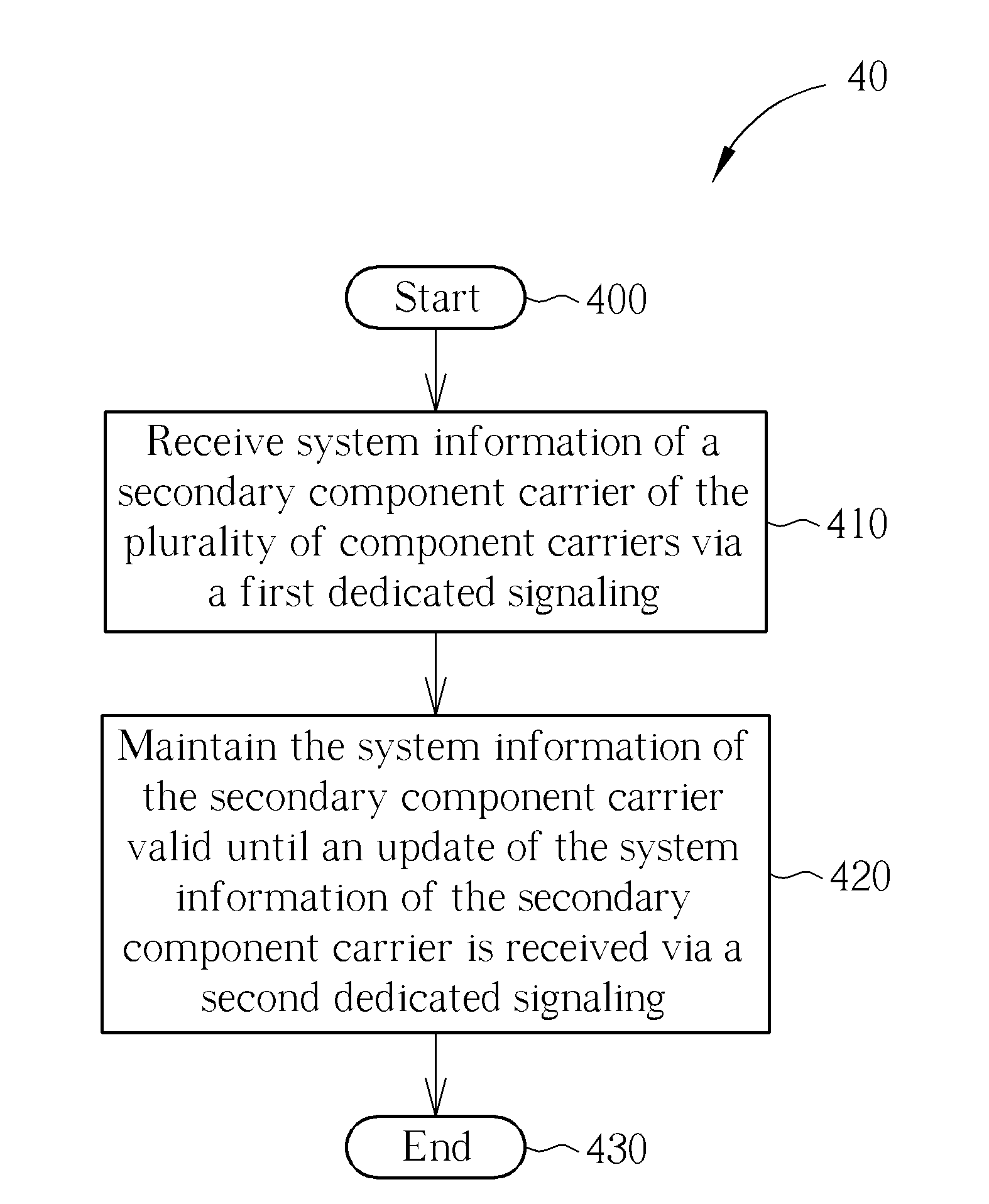

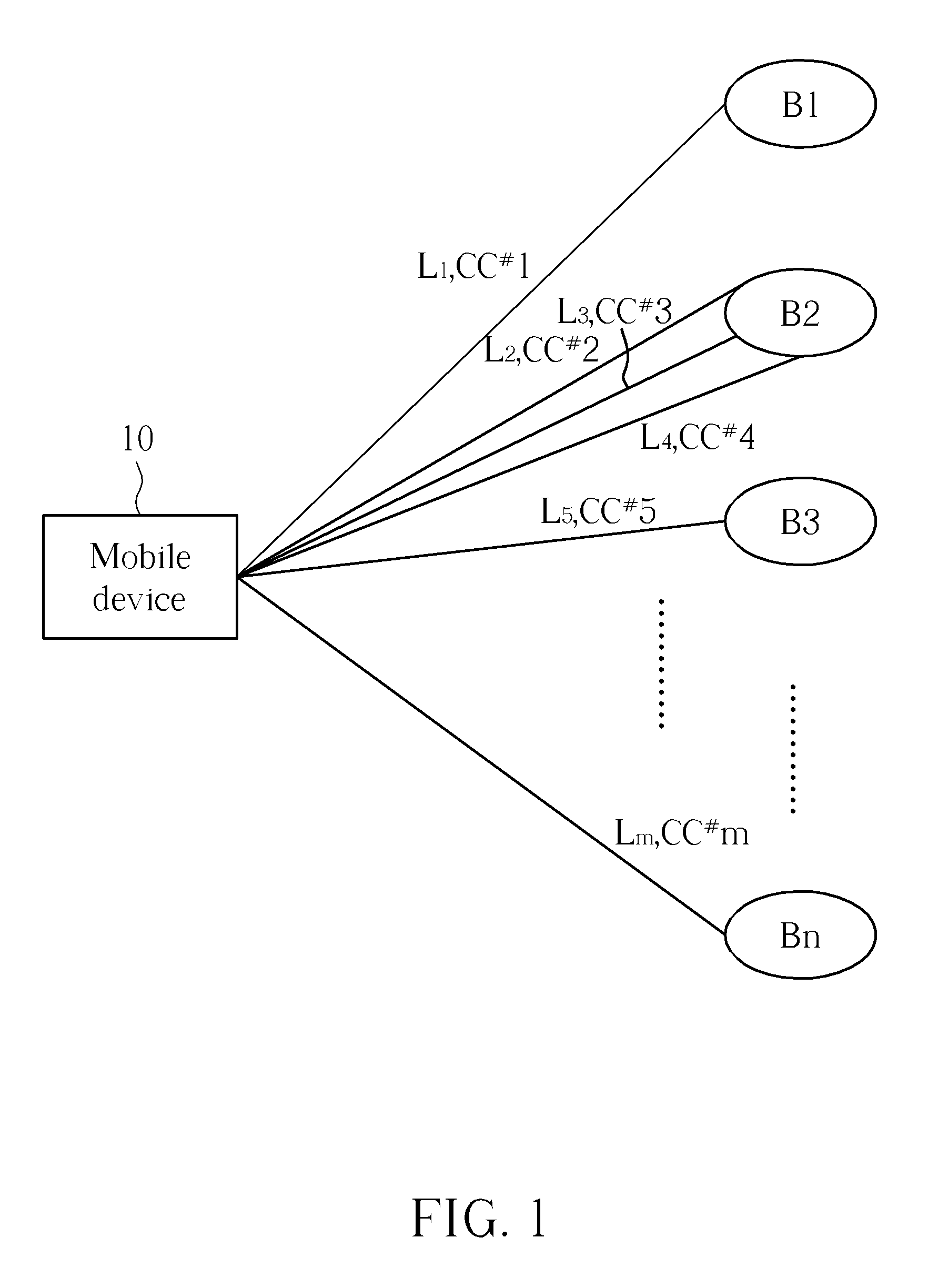

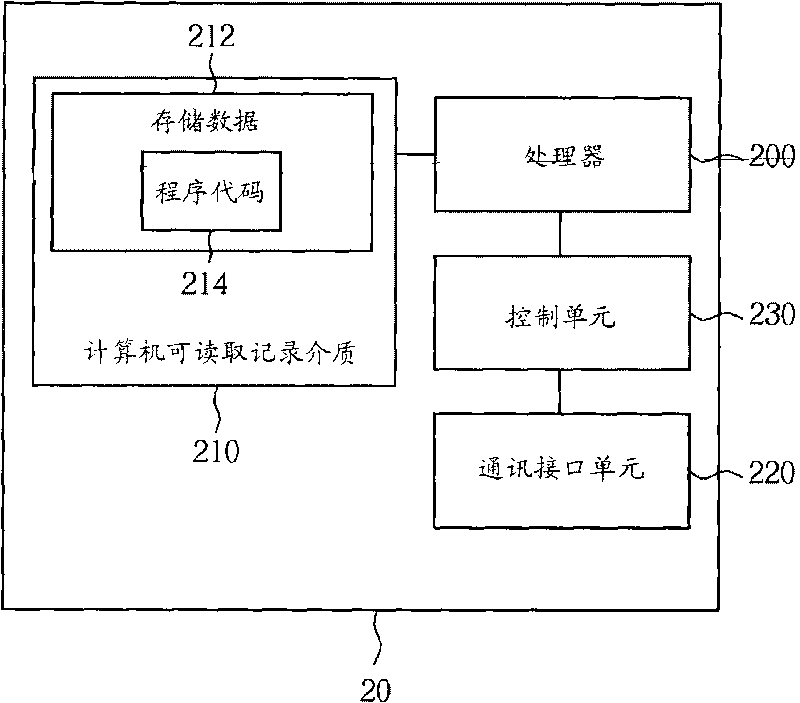

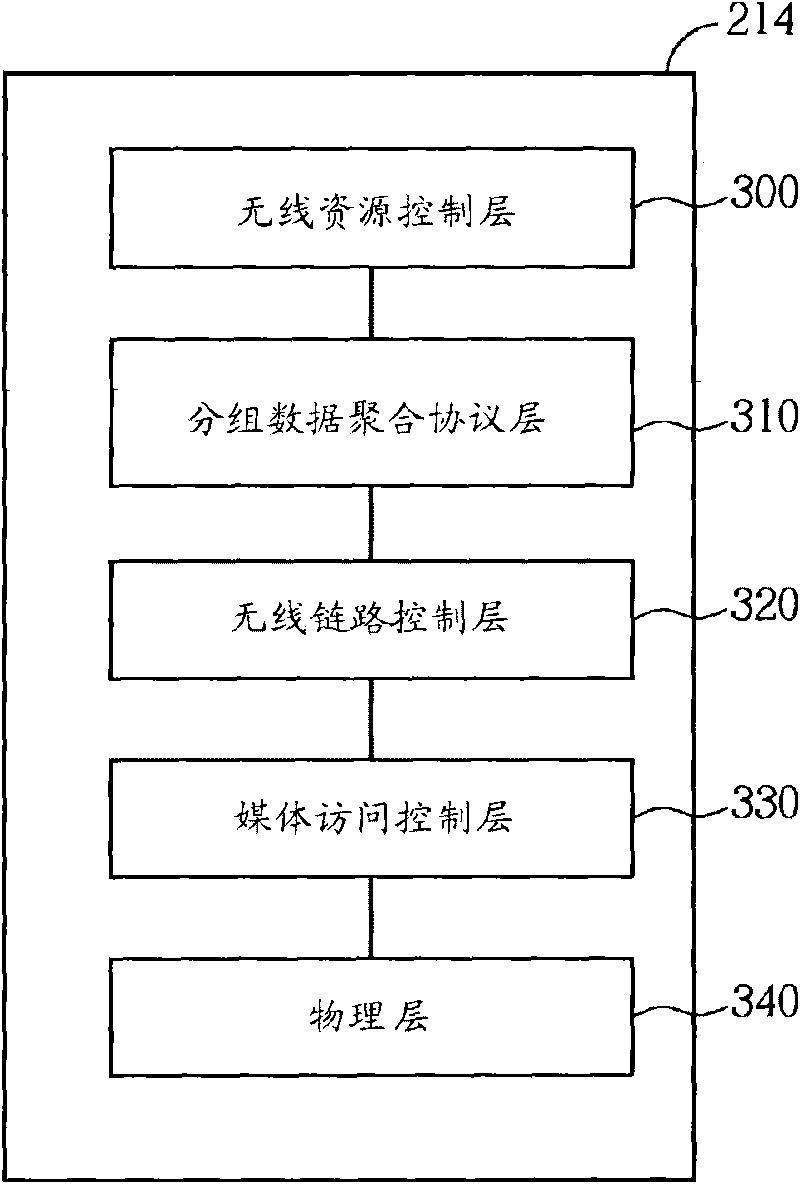

Method of Handling System Information Reception and Related Communication Device

ActiveUS20110256858A1Transmission path divisionAssess restrictionCommunications systemRelevant Communications

A method of handling system information reception for a mobile device capable of receiving and transmitting on a plurality of component carriers in a wireless communication system is disclosed. The method comprises receiving system information of a secondary component carrier of the plurality of component carriers via a first dedicated signaling, and maintaining the system information of the secondary component carrier valid until an update of the system information of the secondary component carrier is received via a second dedicated signaling.

Owner:HTC CORP

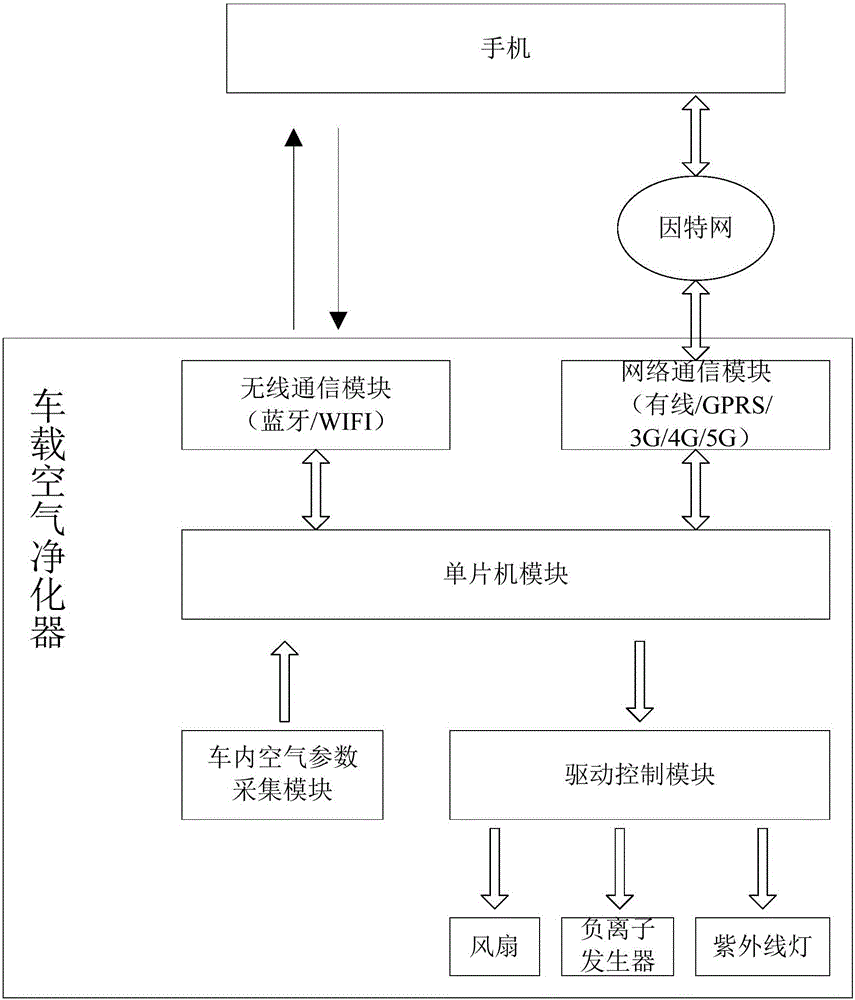

Vehicle-mounted air purifier based on mobile phone control

InactiveCN105115107AEasy to controlRealize remote controlMechanical apparatusSpace heating and ventilation safety systemsMicrocomputerMicrocontroller

The invention discloses a vehicle-mounted air purifier based on mobile phone control, which comprises a fan, an anion generator, an ultraviolet lamp, a drive control module, a single chip microcomputer module and a wireless communication module and a network communication module which are used to realize communication connection with mobile phone equipment, wherein the wireless communication module and the network communication module are respectively connected to relevant communication ports of the single chip microcomputer module, a control instruction input end of the drive control module is connected to a control instruction output end of the single chip microcomputer module, and the single chip microcomputer module receives a control instruction sent by the mobile equipment through the wireless communication module or the network communication module and then sends the control instruction to the drive control module. A user can control the vehicle-mounted air purifier provided by the invention through the mobile phone equipment. The vehicle-mounted air purifier provided by the invention can be installed at any required position inside a vehicle, can satisfy an installation position demand inside the vehicle, can realize convenient control by a mobile phone and can realize remote control when the user leaves the vehicle.

Owner:GUANGZHOU YONGHONG ELECTRONICS

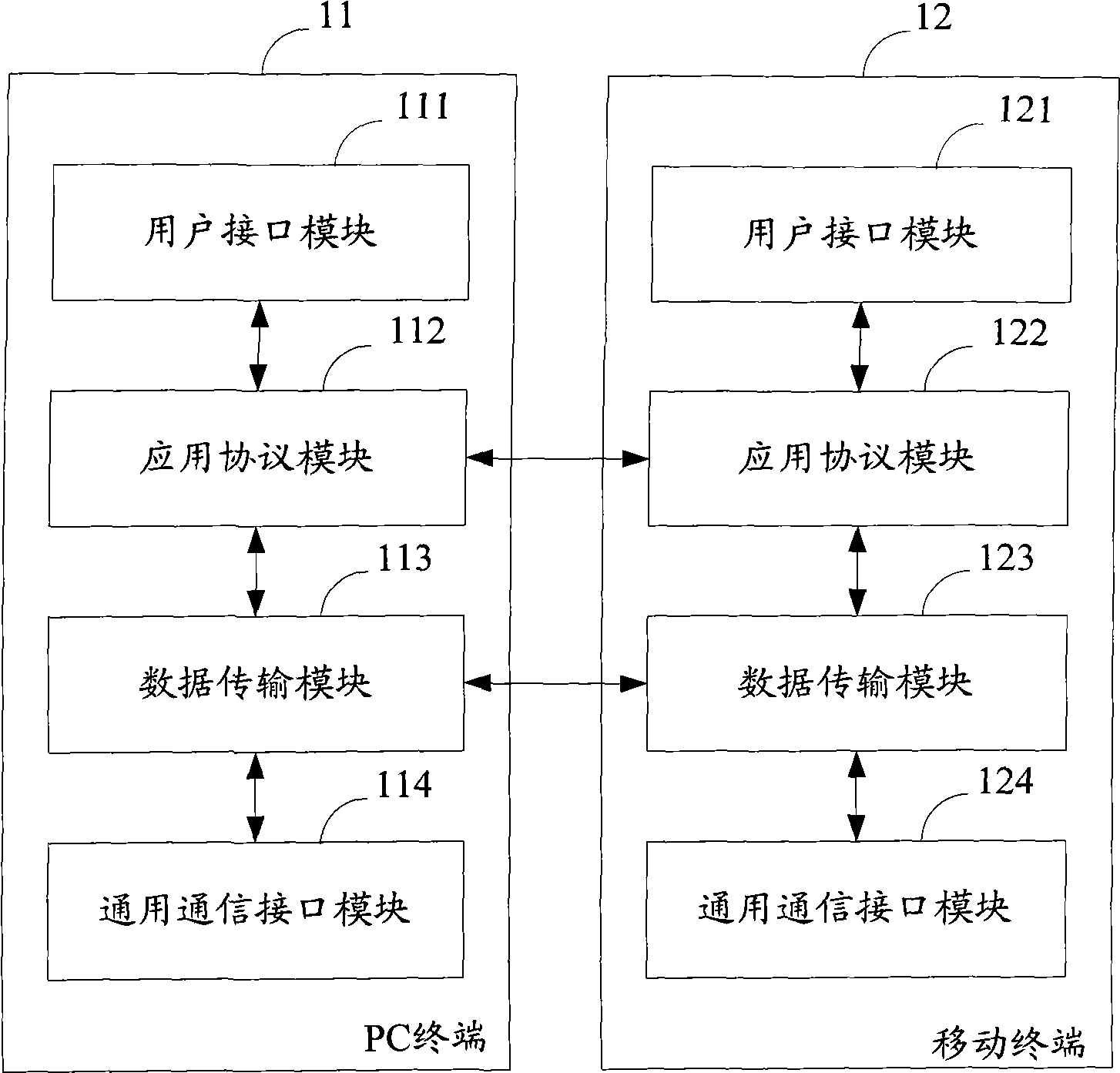

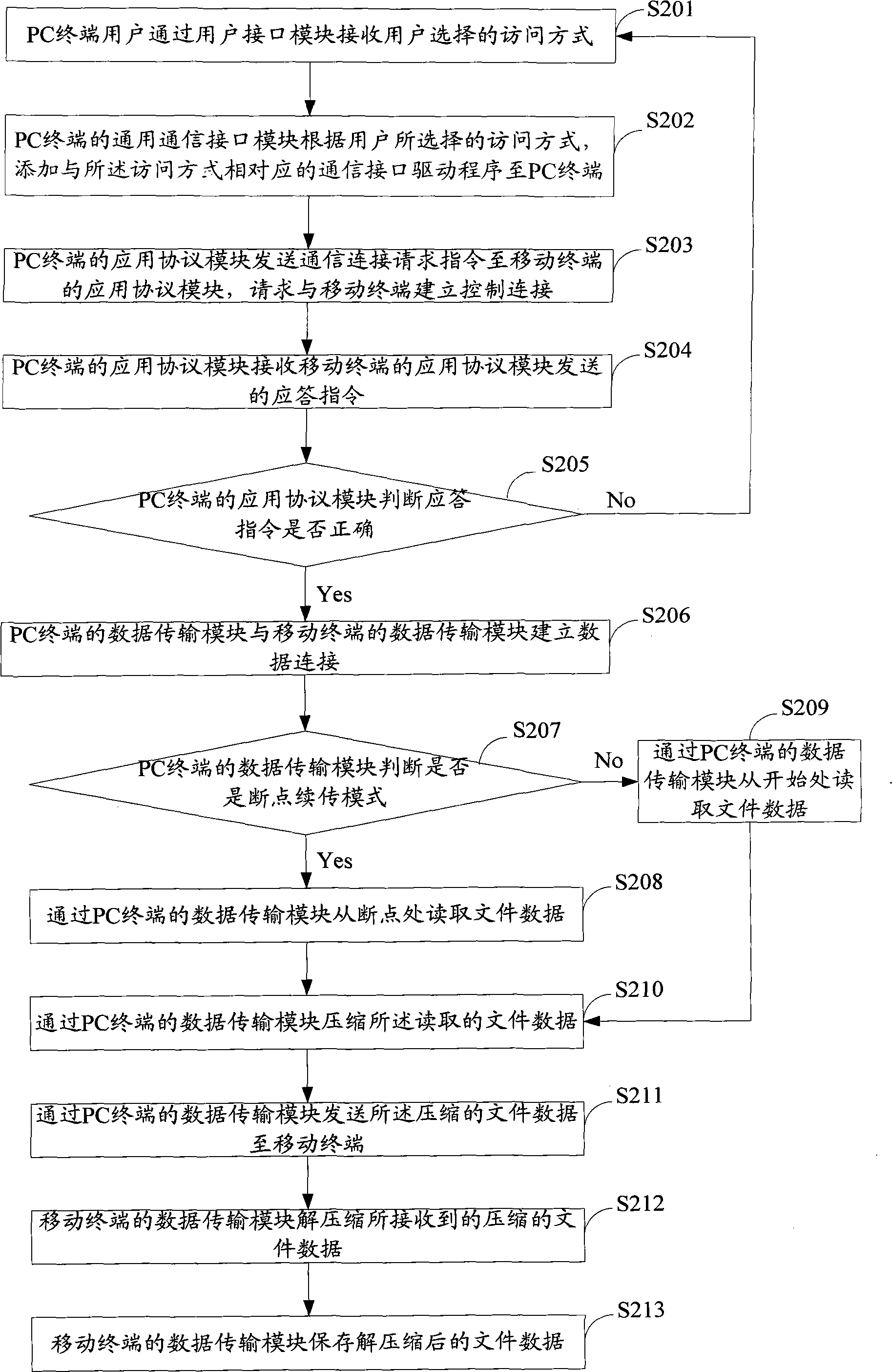

File sharing system and method between PC terminal and mobile terminal

InactiveCN101520803AAchieve sharingImprove scalabilityTransmissionSpecial data processing applicationsData connectionExtensibility

The invention provides a PC terminal which is suitable for the technical field of mobile communication and shares files with a mobile terminal. The PC terminal comprises a user interface module, an application protocol module, a data transmission module and a general communication interface module, wherein the user interface module is used for receiving access methods selected by users, the application protocol module is used for establishing control connection with the mobile terminal, the data transmission module is used for establishing data connection with the mobile terminal, and the general communication interface module is used for loading a relevant communication interface drive to the PC terminal according to an access method selected by the user interface module of a PC terminal user. The invention has the advantage that the PC terminal or the mobile terminal appends relevant communication interface drivers according to access methods selected by the users, i.e. the PC terminal or the mobile terminal can share the files through relevant access methods, thereby enhancing the expansibility and the convenience of a PC terminal or mobile terminal system.

Owner:YULONG COMPUTER TELECOMM SCI (SHENZHEN) CO LTD

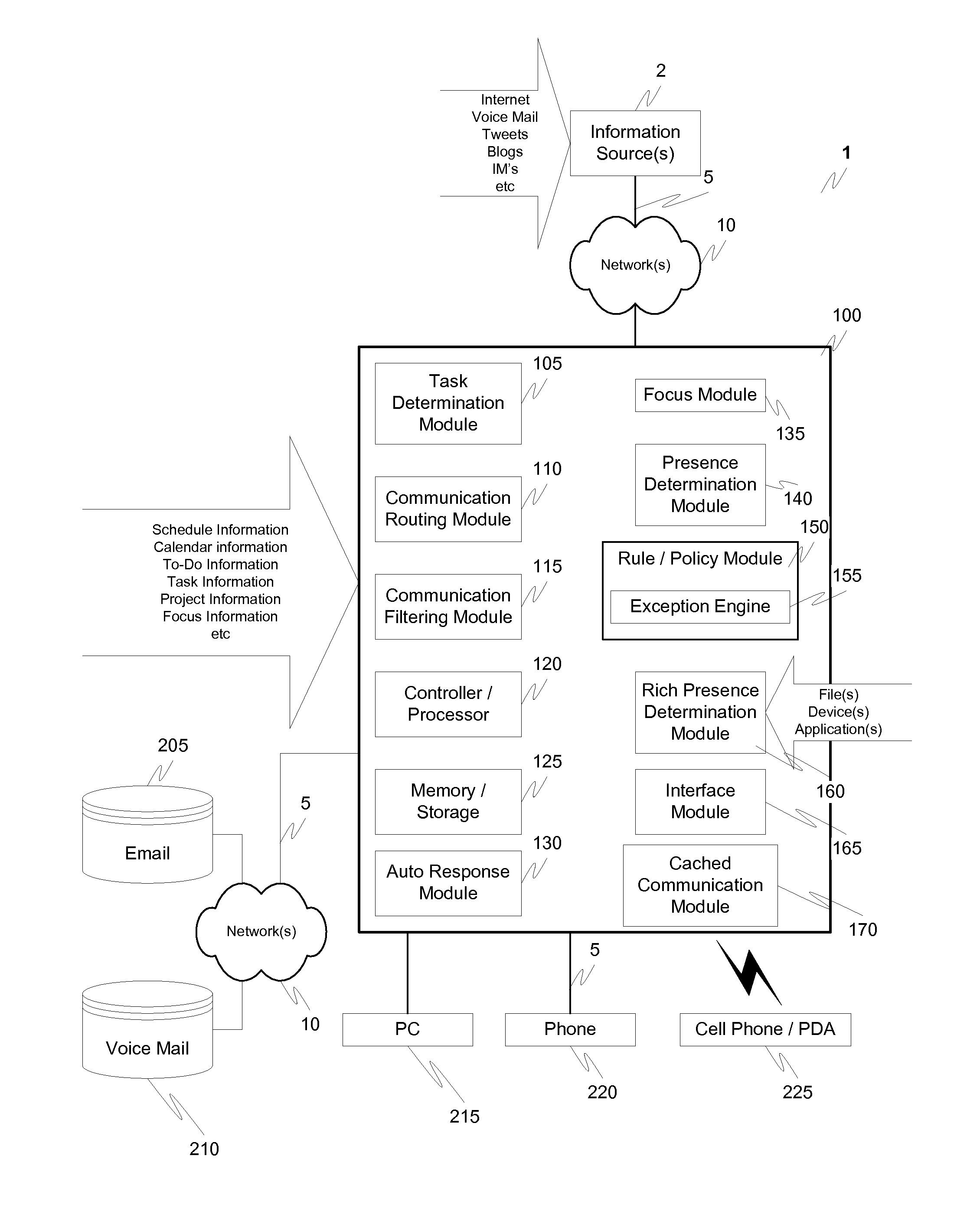

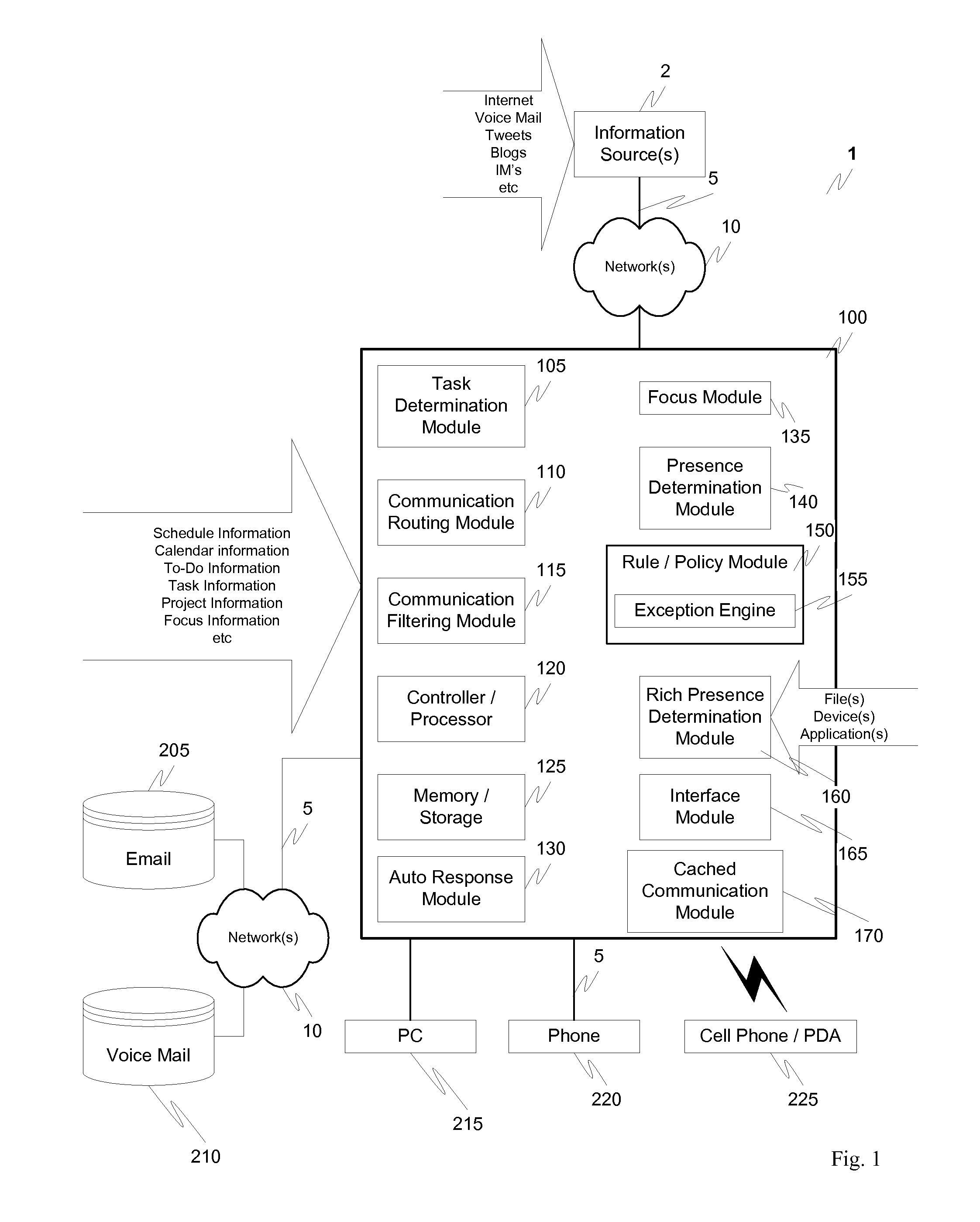

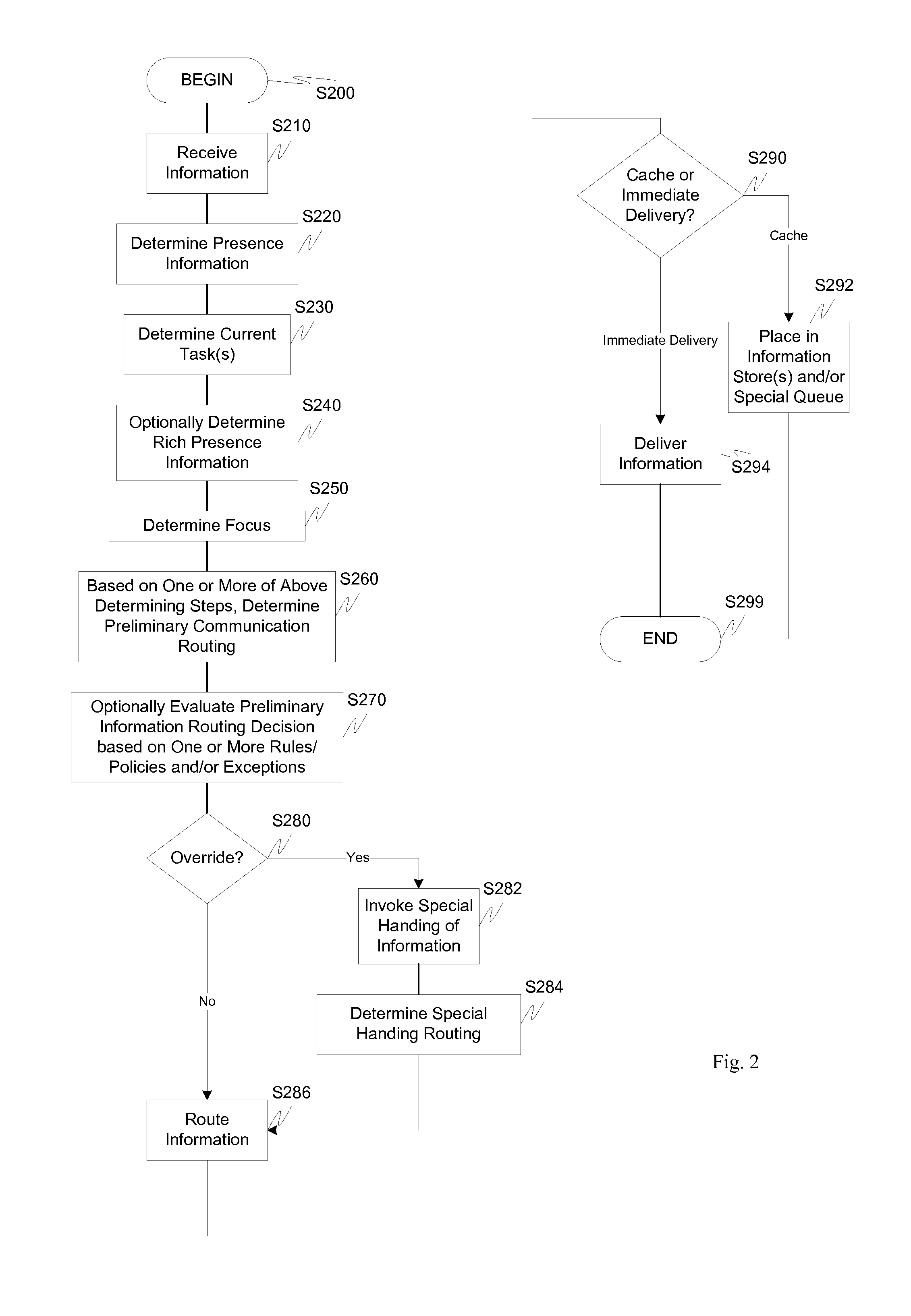

Task-oriented communication filter method and apparatus

ActiveUS20110246668A1Eliminate distractionsImprove definitionData processing applicationsMultiple digital computer combinationsInbound communicationActivity monitor

A variety of mechanisms are used to determine a user's task orientation. Rich presence detection could be used to identify whether a person is at home, at work, traveling, or the like. Temporal factors can also be considered to determine a user's probable persona such as working, personal time, traveling (business or personal), and the like. Entries in a user's calendar application and / or to-do-list reminders can be searched to add information about a user's task orientation and up-coming deliverables. Activity monitors on phones, computers, and the like, can be used to determine files be accessed, applications being used, out-bound communications being sent, in-bound communications, up-coming meetings, and the like, to further refine the nature of a user's tasks. A program evaluates all of these information sources to determine a user's focus and presents topically relevant communications and filters the rest to keep the user from being interrupted.

Owner:AVAYA INC

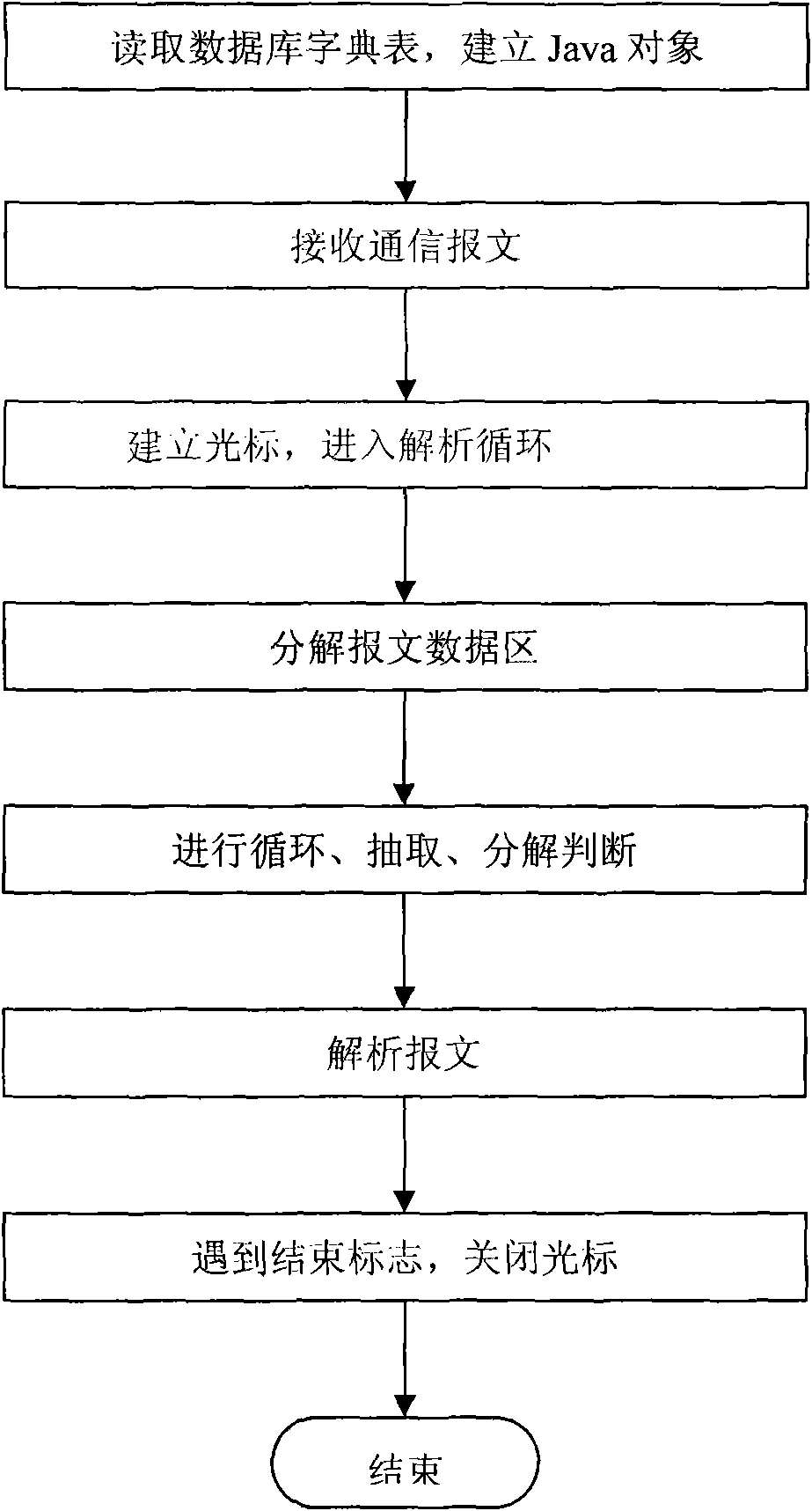

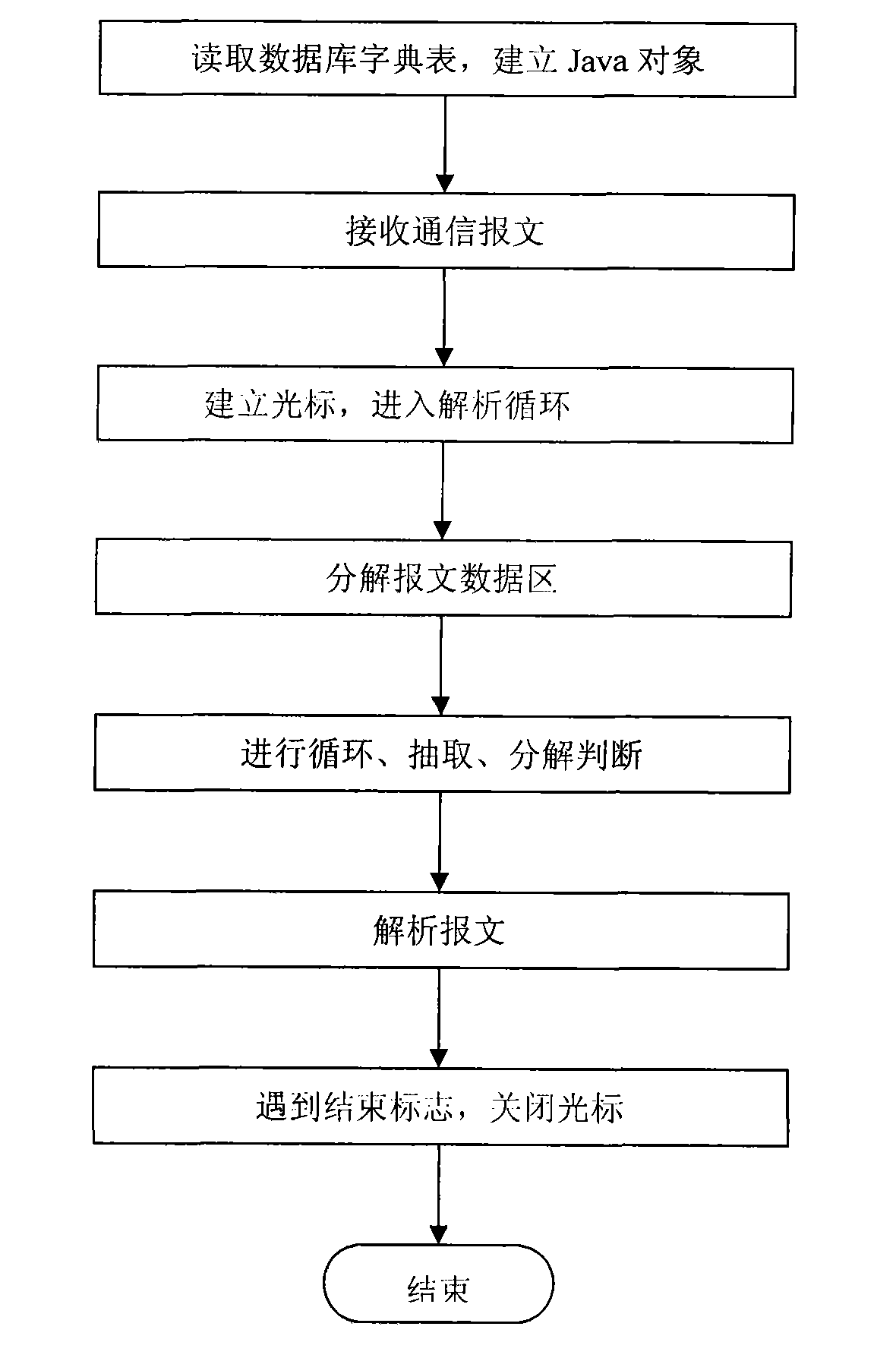

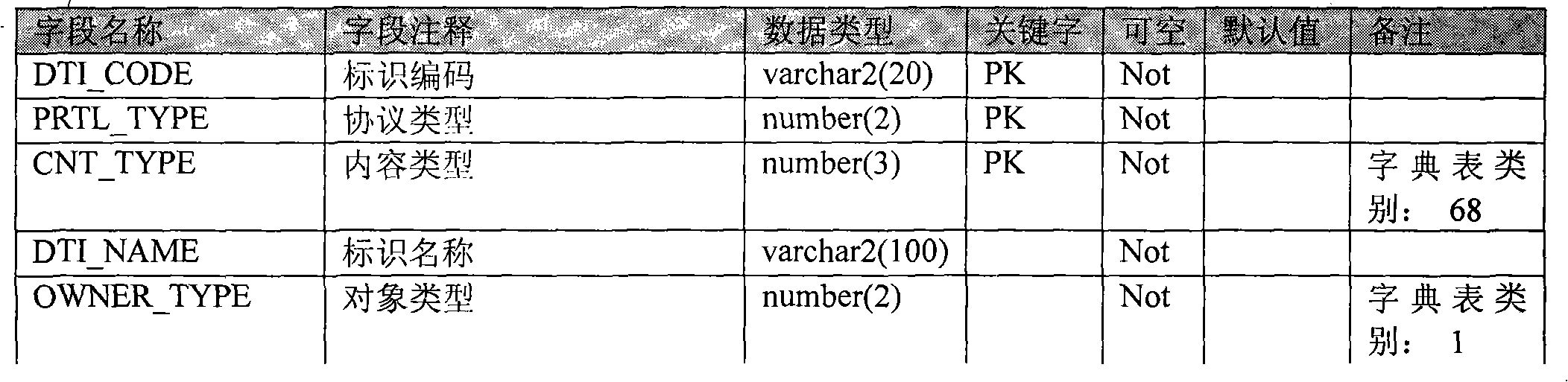

Method compatible with plurality of types of communication protocols of electric negative control system simultaneously and system thereof

ActiveCN101777791AImprove compatibilityEasy to deployCircuit arrangementsElectric power systemRelevant Communications

The invention provides a method compatible with a plurality of types of communication protocols of an electric negative control system simultaneously, comprising the following steps that: an electric system is provided; the electric system carries out abstract modeling on the communication protocols; database is initiated when the electric system is started; and the electric system reads the content of the database and instantiates Java objects of relevant communication service programs. The invention also provides a system compatible with the plurality of types of communication protocols of the electric negative control system simultaneously.

Owner:深圳龙电华鑫控股集团股份有限公司

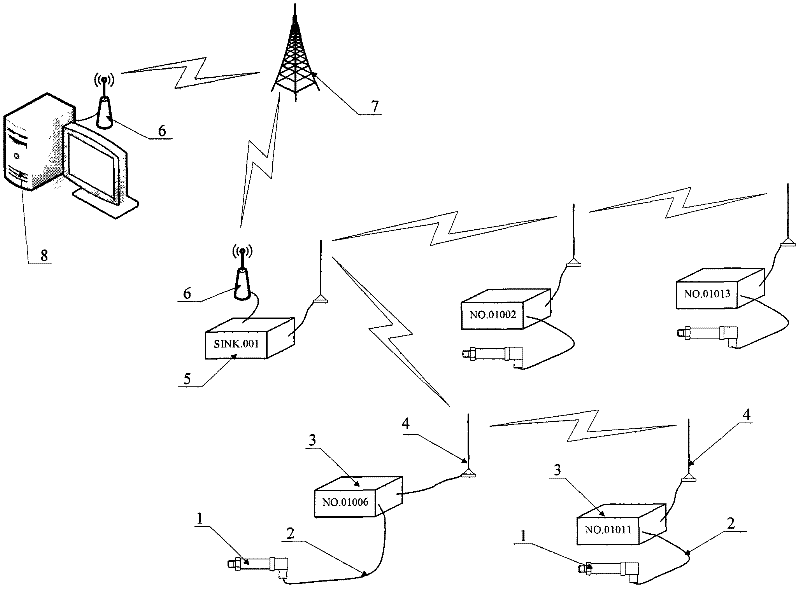

Wireless monitoring system of municipal pipe network

InactiveCN102548029AGuaranteed reliabilityReduce lossEnergy efficient ICTNetwork topologiesModel selectionRelevant Communications

The invention discloses a wireless monitoring system of a municipal pipe network, which is composed of a monitoring node, a Sink node, an upper computer, relevant communication protocols and application software and the like. Optimizing methods for a wireless self-organization communication protocol, energy-saving application, monitoring position selection and the like are further disclosed. The optimizing methods of the wireless self-organization communication protocol include precise synchronization, failure prediction, frequency conversion interference, time division optimization, channel space optimization sharing and the like. An energy-saving application optimizing method includes model selection of low power consumption hardware, design of a power supply protective circuit, optimizing design of a circuit board, a dormant optimizing mechanism, duty ratio optimization, transmission power optimization and the like. A point position optimizing selecting method is particularly a method for searching the most sensitive point in a certain monitoring area. By means of the various optimizing methods, low cost, low power consumption, safety, reliability, intelligence, efficiency and automation of monitoring of the municipal pipe network are achieved.

Owner:中机生产力促进中心有限公司

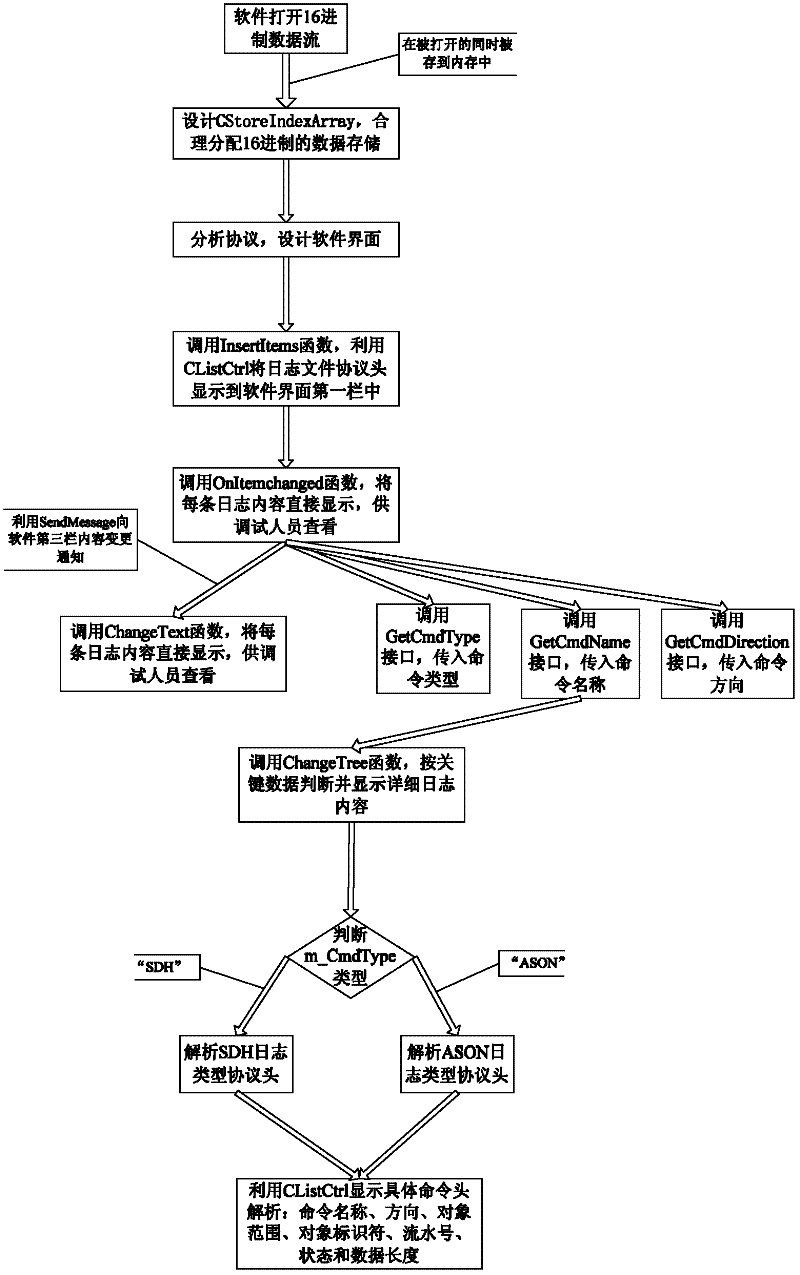

Method for analyzing and managing log file with hexadecimal data

The invention relates to a method for analyzing and managing a log file with hexadecimal data, which comprises the following steps: obtaining the content of a log file with hexadecimal data, which is recorded in a form of the hexadecimal data, in the process of opening the log file with the hexadecimal data, and loading the obtained hexadecimal data by using a multi-dimensional array; and combining the hexadecimal data in the multi-dimensional array and a relevant communication protocol together for analyzing by row division and byte division, reading the content in the hexadecimal data into information which can be directly read and also displaying the information on a man-machine interactive interface, wherein a multi-layer display mode is adopted for the man-machine interactive interface, and the relevant communication protocol is a private communication protocol corresponding to the log file. According to the method disclosed by the invention, the content of a log file with hexadecimal data generated by communication software can be analyzed; and moreover, by combining the relevant communication protocol, the content of the log file, which is recorded by the hexadecimal data, is read into the information which can be directly read, and the information is also displayed by changing the protocol. The method for analyzing and managing the log file with the hexadecimal data can be used for conveniently managing and analyzing the log file with the hexadecimal data.

Owner:FENGHUO COMM SCI & TECH CO LTD

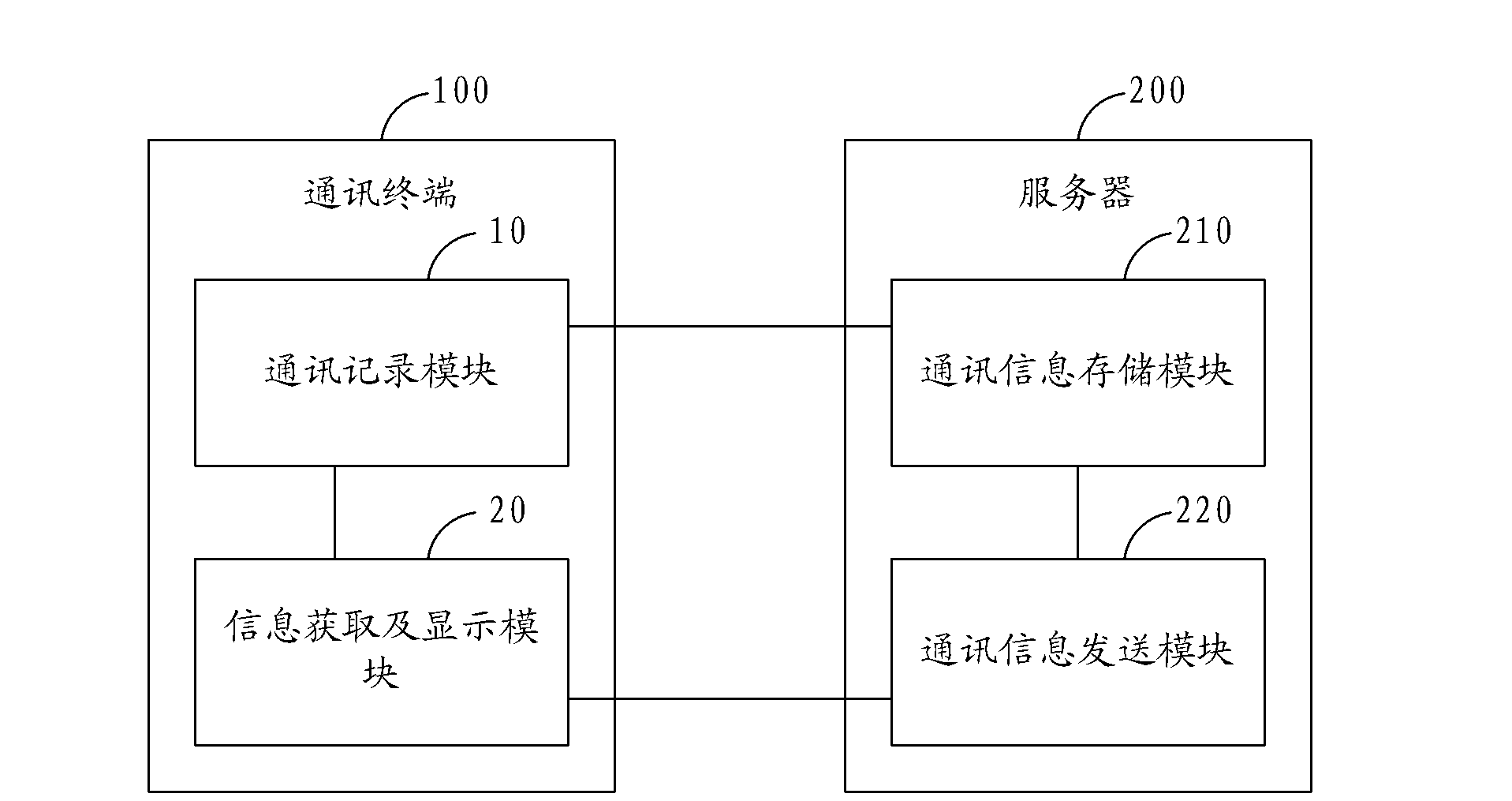

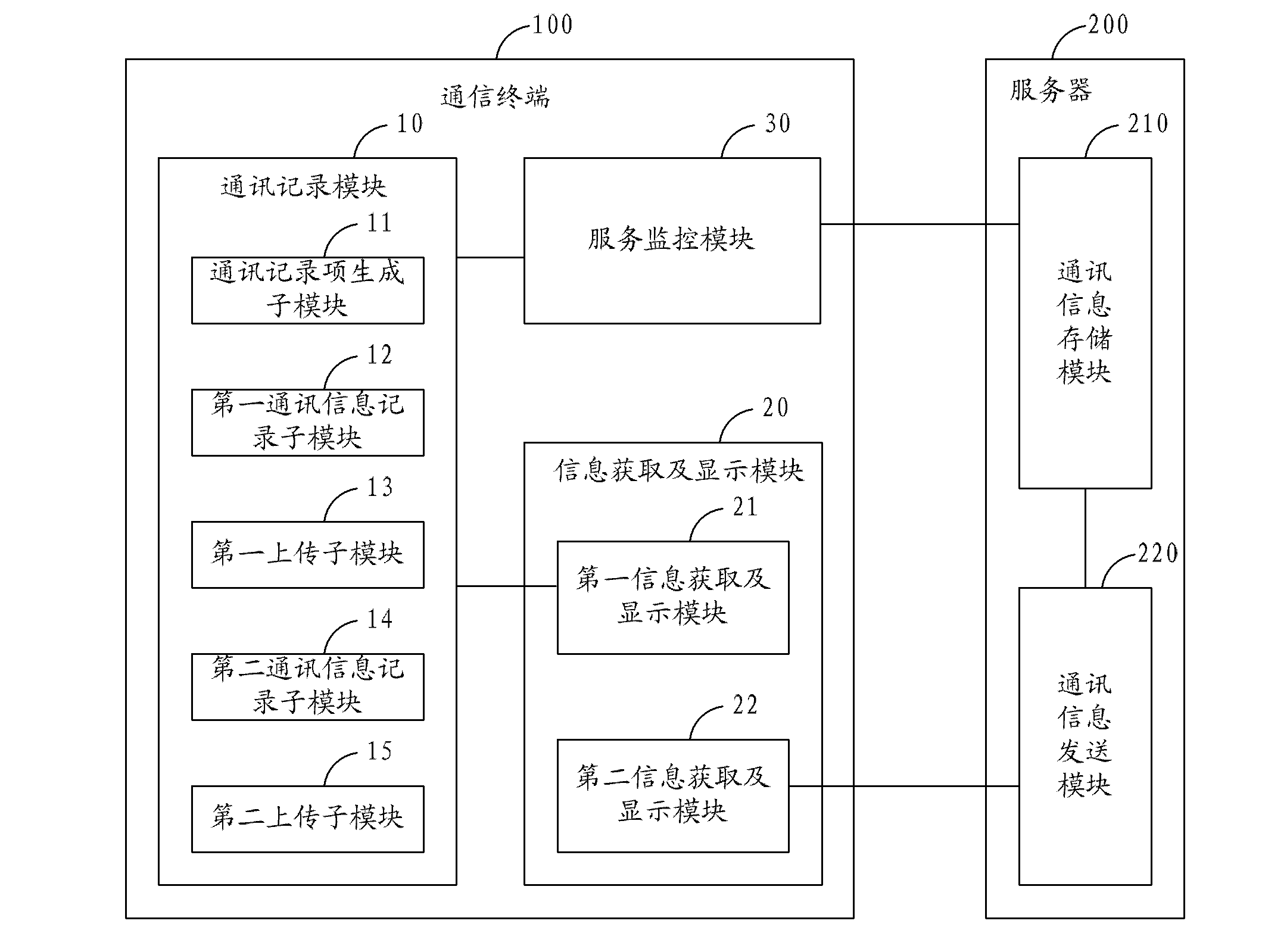

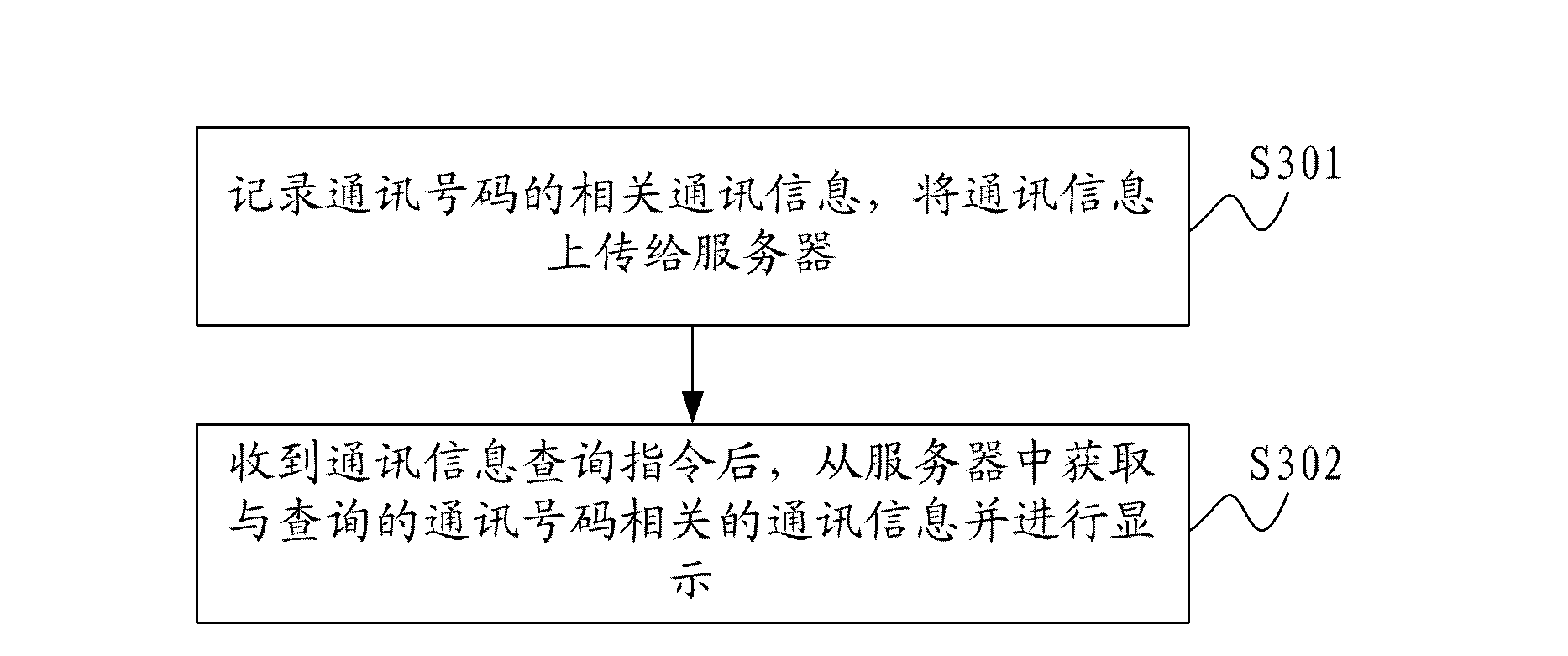

Method and system for displaying communication records in communication terminal and communication terminal

ActiveCN103167085AImprove user experienceReduce hardware storage requirementsSubstation equipmentTransmissionComputer terminalTelecommunications

The invention relates to the technical field of communications, and provides a method and a system for displaying communication records in a communication terminal, and the communication terminal. The method includes the following steps: communication information related to a communication number is recorded and uploaded to a server; and after a communication information query instruction is received, the communication information related to the queried communication number is obtained from the server and displayed. Therefore, the method and the system for displaying the communication records in the communication terminal lower the requirements of the application of the communication records on hardware storage of the communication terminal and the server, and can increase the query speed of communication record data.

Owner:YULONG COMPUTER TELECOMM SCI (SHENZHEN) CO LTD

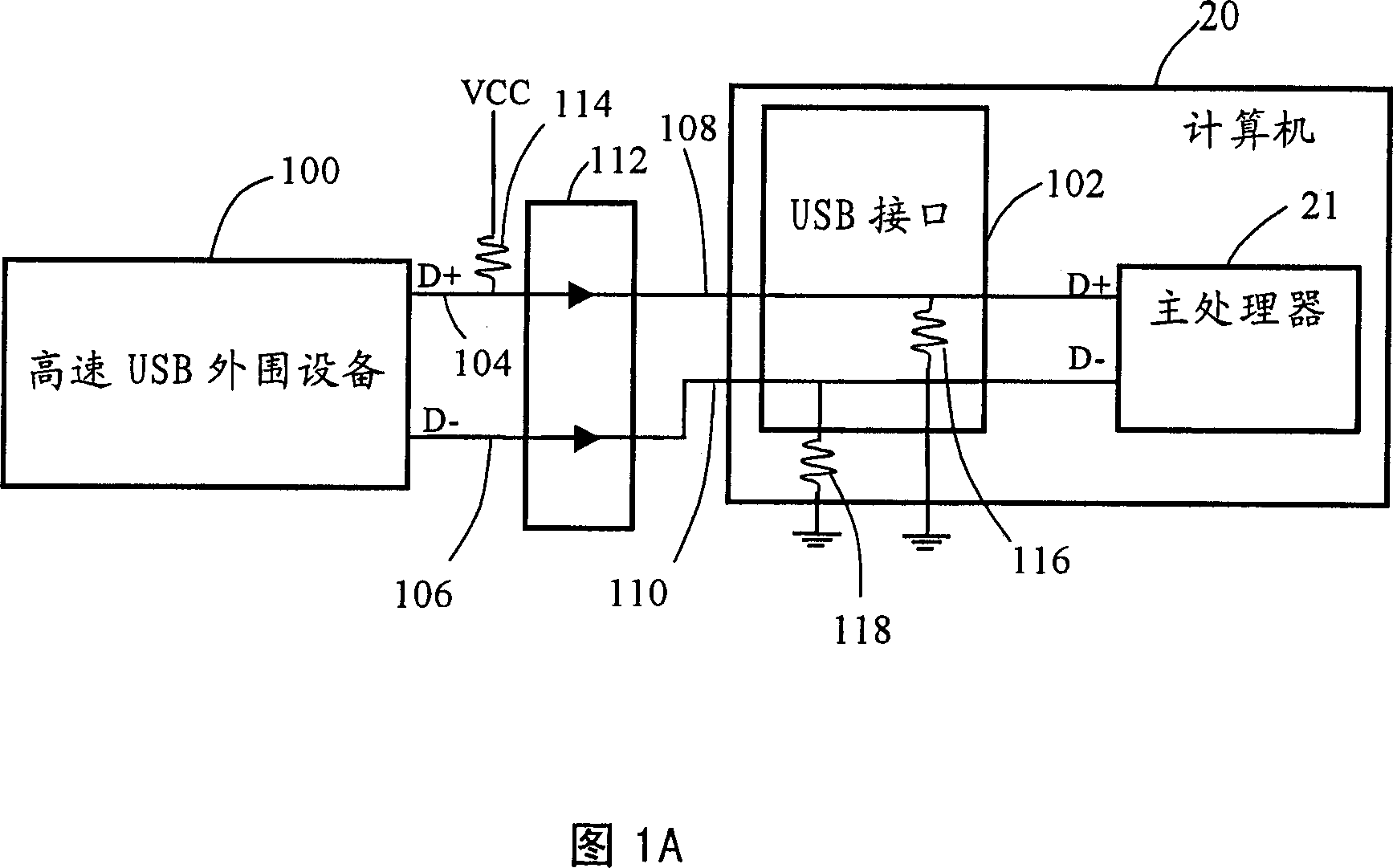

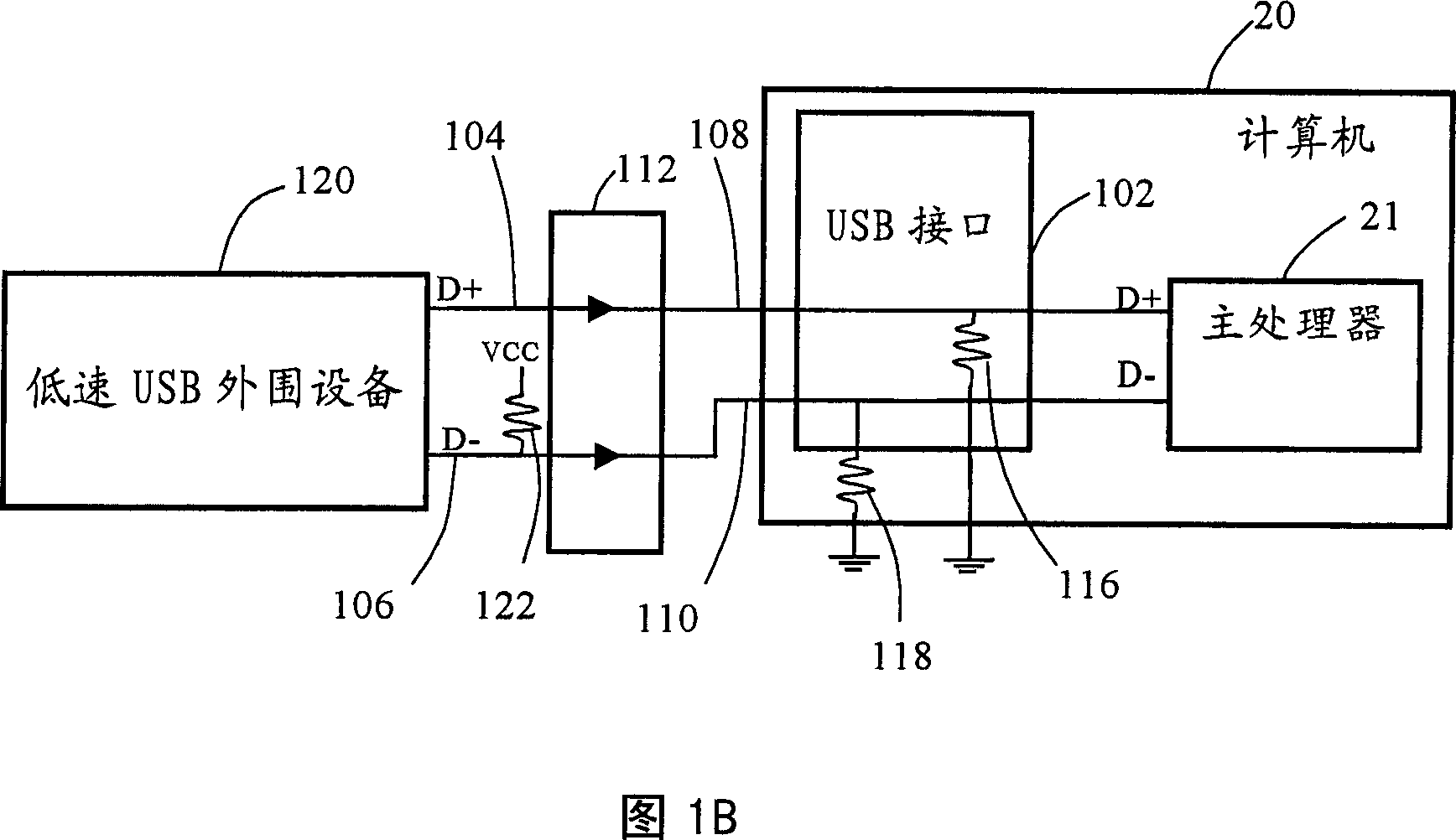

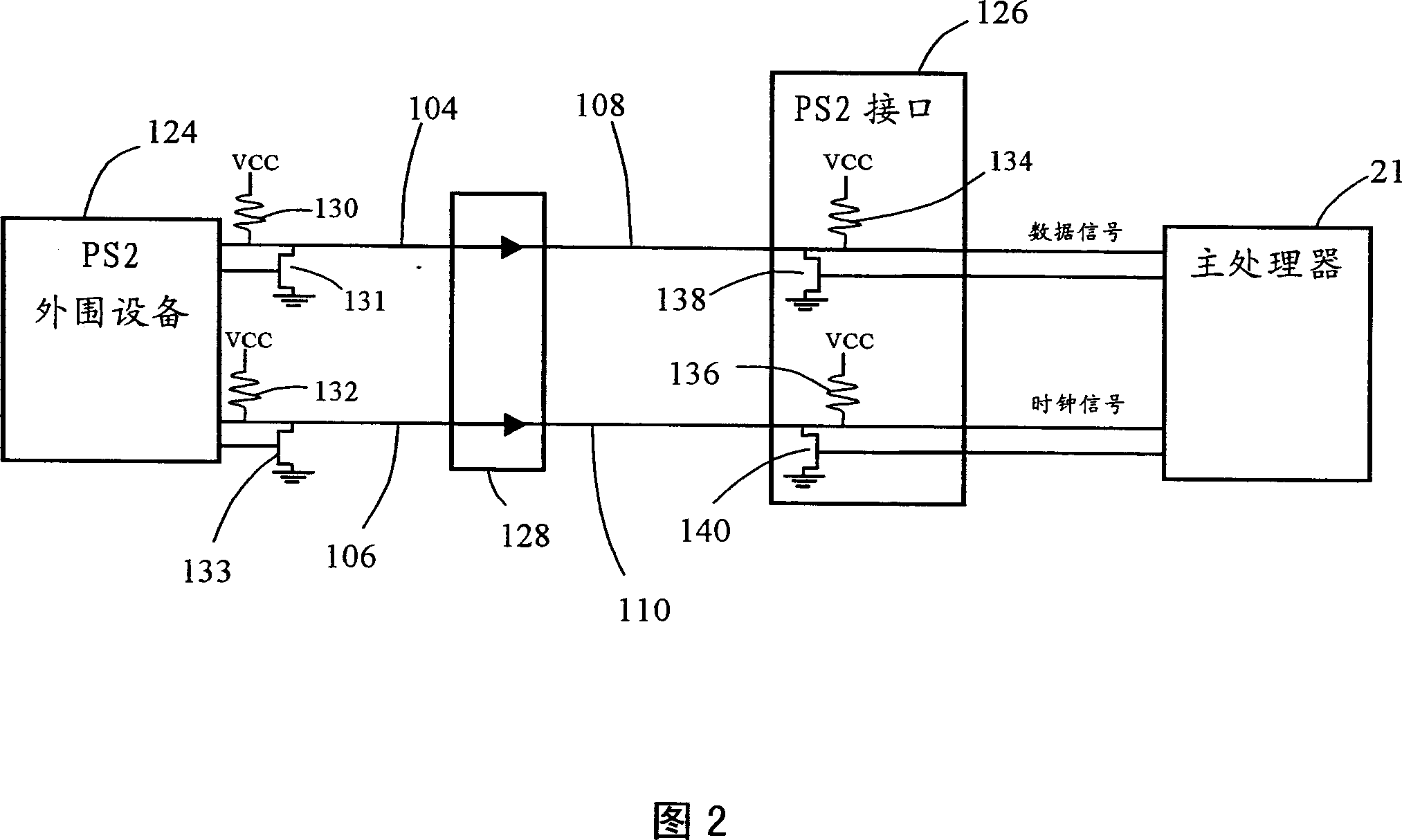

Automatic method for identifying signal interfaces of electronic equipment

InactiveCN1959664AAccurate automatic recognition effectJudgment is normalElectric digital data processingSystems designRelevant Communications

A method for automatically identifying signal interface of electronic device includes entering confirmation judgment course after prejudgment course and automatically jumping to another interface mode if prejudgment error is discovered then locking the state after relevant communication command from host system is received so that interface type connected with peripheral units can be automatically identified.

Owner:APEXONE MICROELECTRONICS SHANGHAI +1

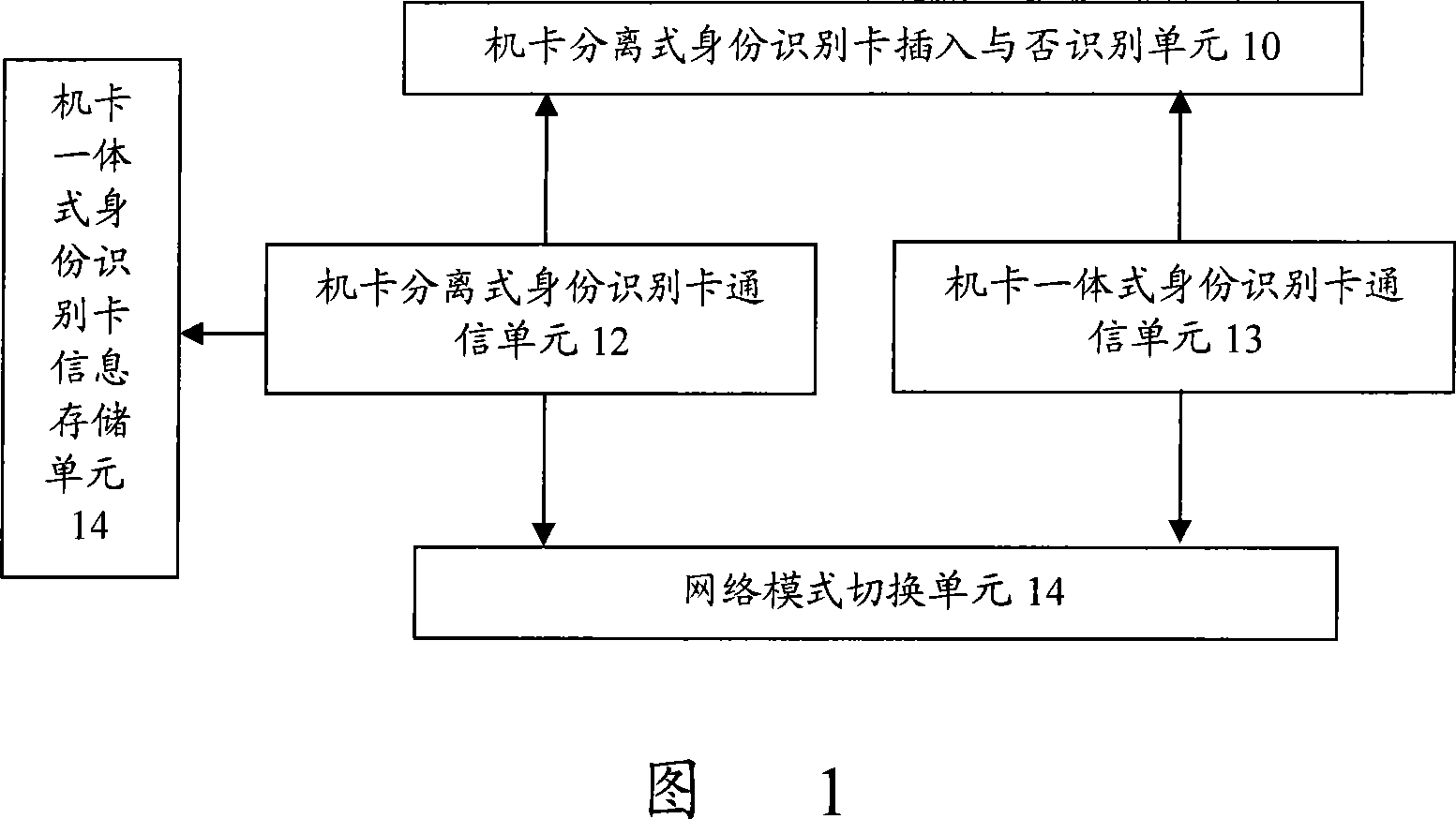

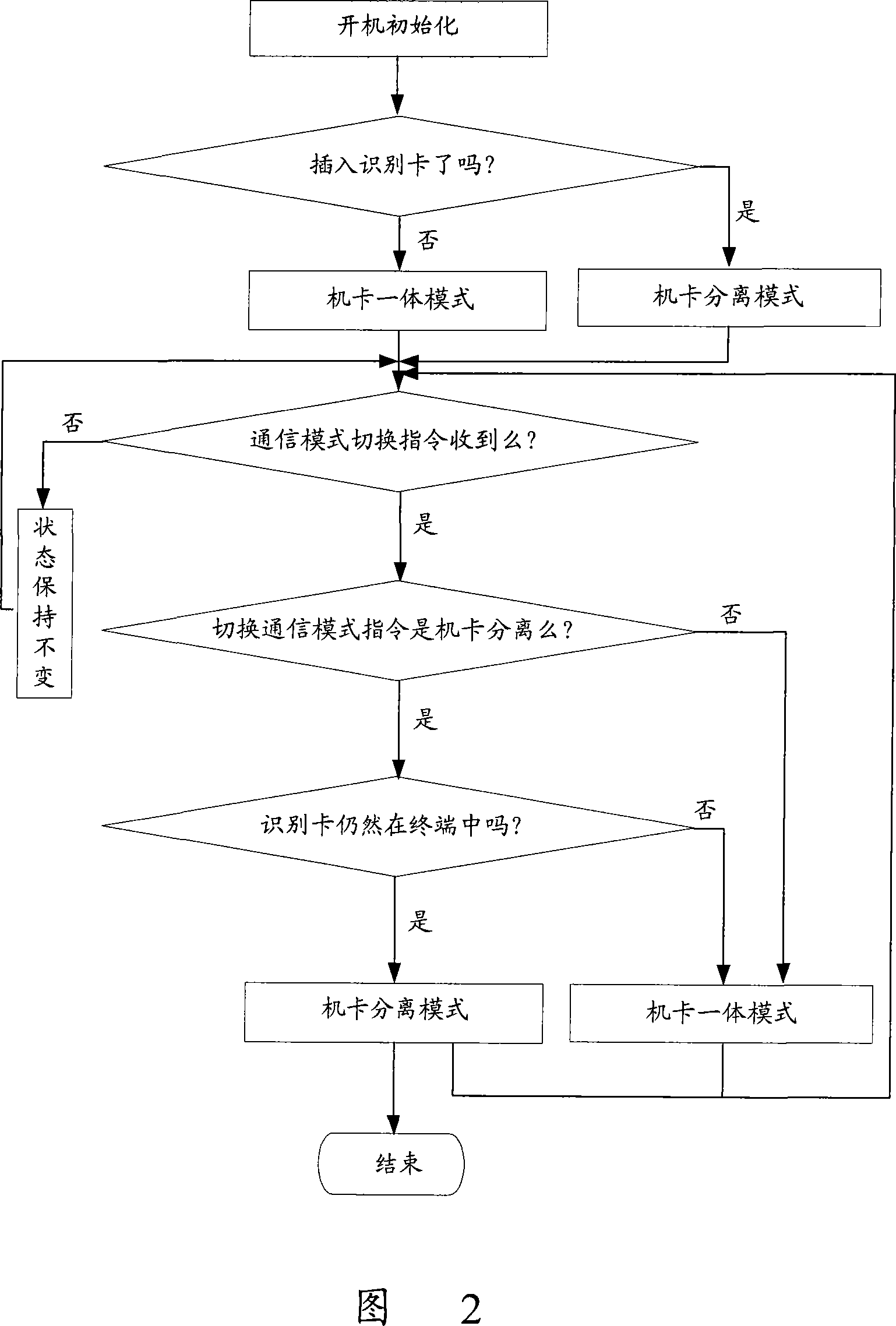

Mobile terminal for supporting machine and card integration and machine and card separation

InactiveCN101068424AGood choiceRadio/inductive link selection arrangementsWireless communicationComputer hardwareCommunication unit

A mobile terminal supporting machine-card in unified body and machine-card in separated body consists of identification unit for judging whether machine-card separation status identification card is inserted on mobile terminal or not, machine-card unified status identification card information storage unit for storing relevant parameters, machine-card separation status identification card communication unit for providing relevant communication service, machine-card unified status identification card communication unit for providing communication service and for changing current operation mode through mode switching-over command of network.

Owner:ZTE CORP

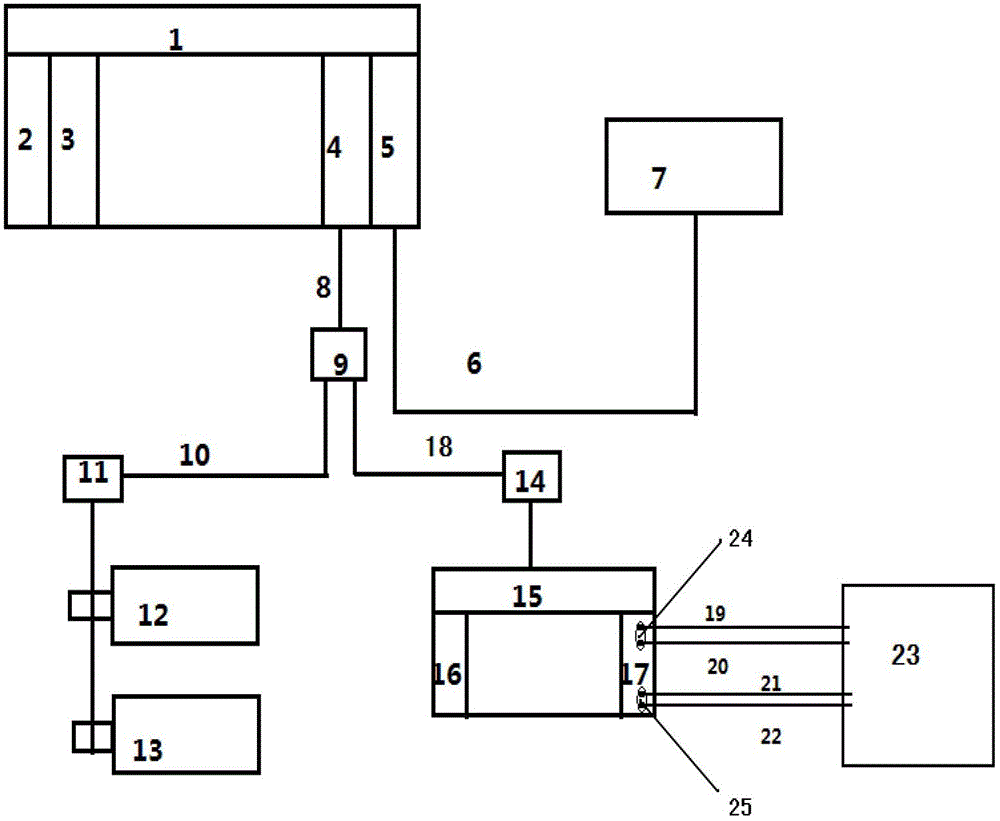

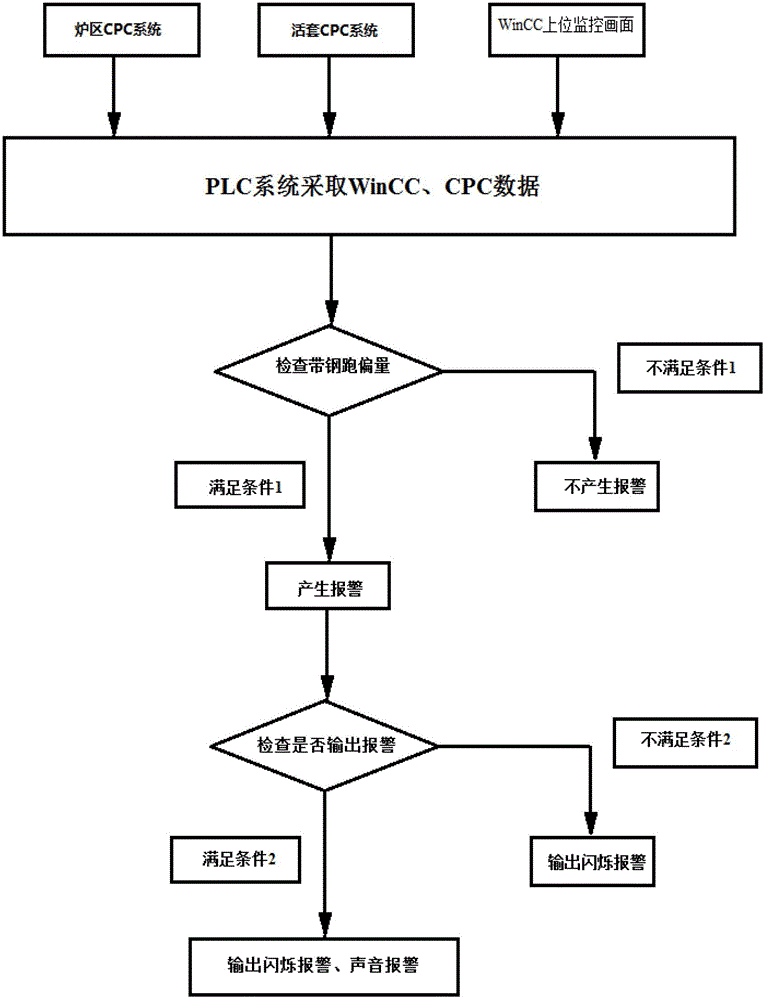

Online strip steel CPC (center position control) audible-visual alarming system

ActiveCN102718089AAvoid constant noiseAvoid downtime across the boardWebs handlingProduction lineProgrammable logic controller

An online strip steel CPC (center position control) audible-visual alarming system belongs to the technical field of strip steel production. The system comprises a CPC device, an S7400 PLC (programmable logic controller), a switch value output module, an audible and visual alarm, an upper monitor reset button, and relevant communication wires, leads, wiring terminals and the like. When deviation of the strip steel from a central line exceeds a preset deviation value, control commands are output by the S7400 PLC through the switch value output module, and audible alarm and visual blinking alarm are generated by the audible and visual alarm simultaneously to alert an operator to take process actions such as reducing speed, adjusting tension and the like, so that the strip steel can be led back to a normal position as soon as possible. A controllable button is further added to an upper monitor interface to improve system functions. The controllable button is used for resetting the audible alarm while the visual blinking alarm continues, so that form of an alarming function is diversified, the alarming function is enhanced, humanization is achieved, and continuous noise disturbance is avoided. The online strip steel CPC audible-visual alarming system has the advantages that shutdown rate of a whole production line due to overrun of the center position control can be reduced greatly, and the online strip steel CPC audible-visual alarming system has fine popularization and application value.

Owner:BEIJING SHOUGANG AUTOMATION INFORMATION TECH

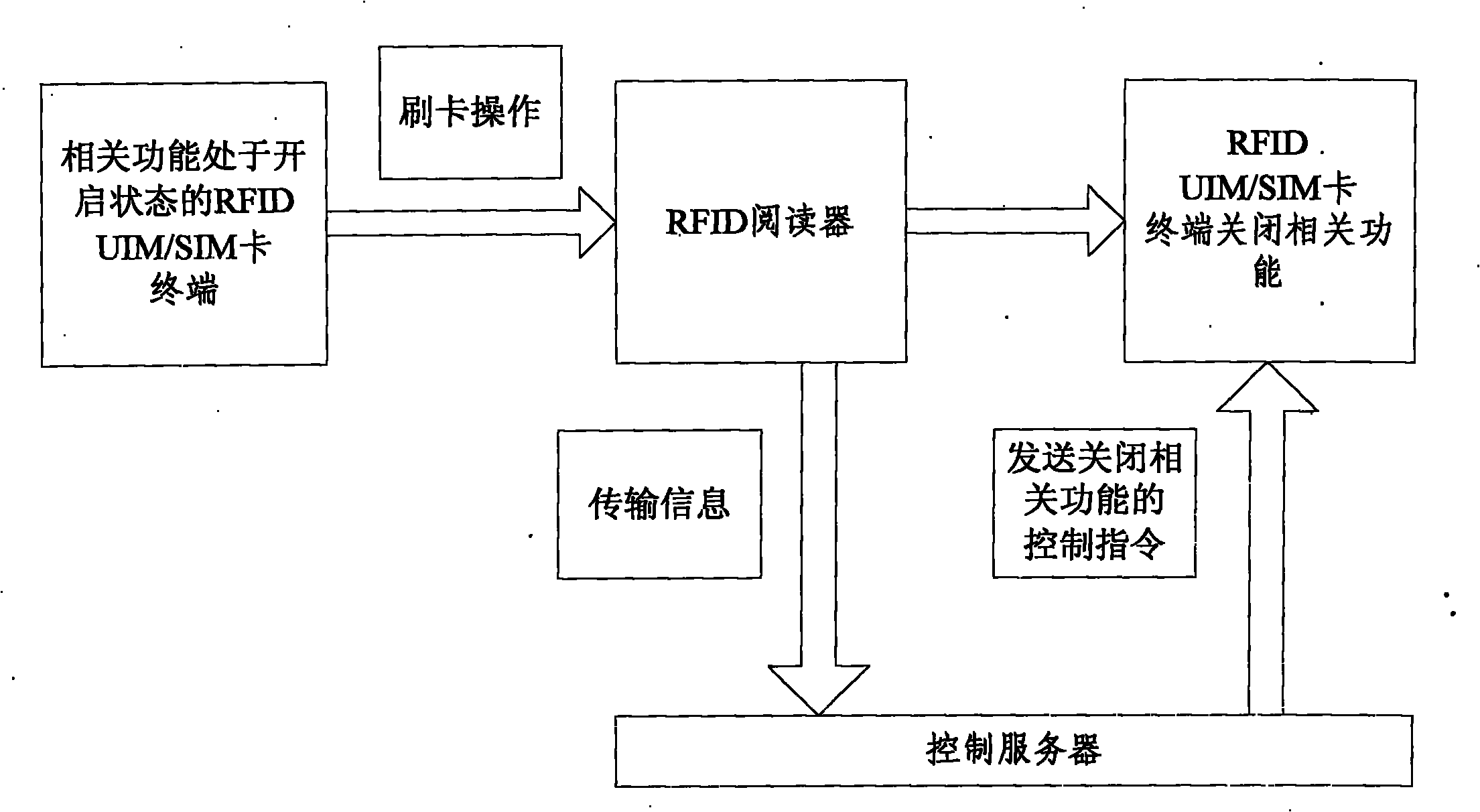

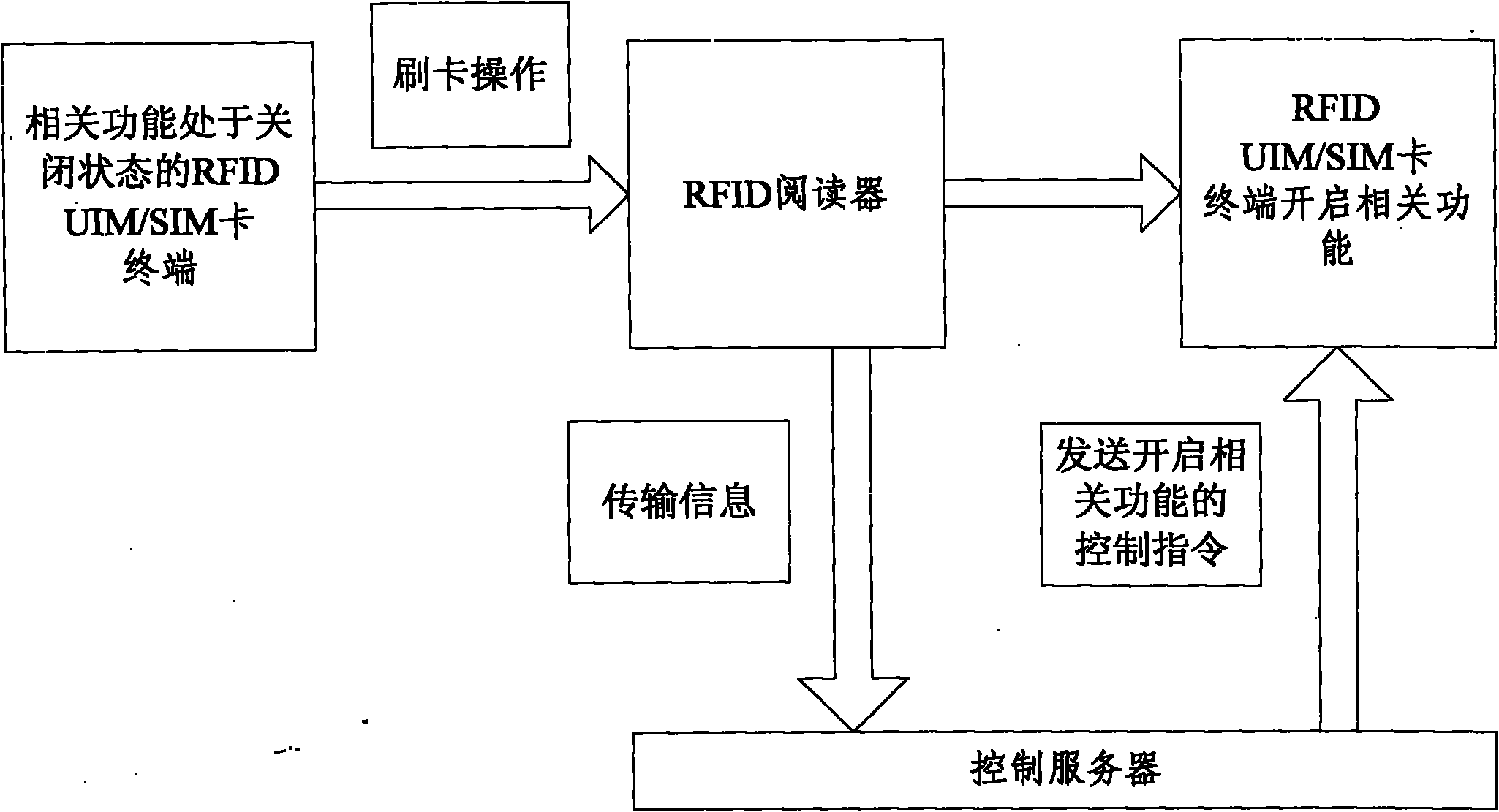

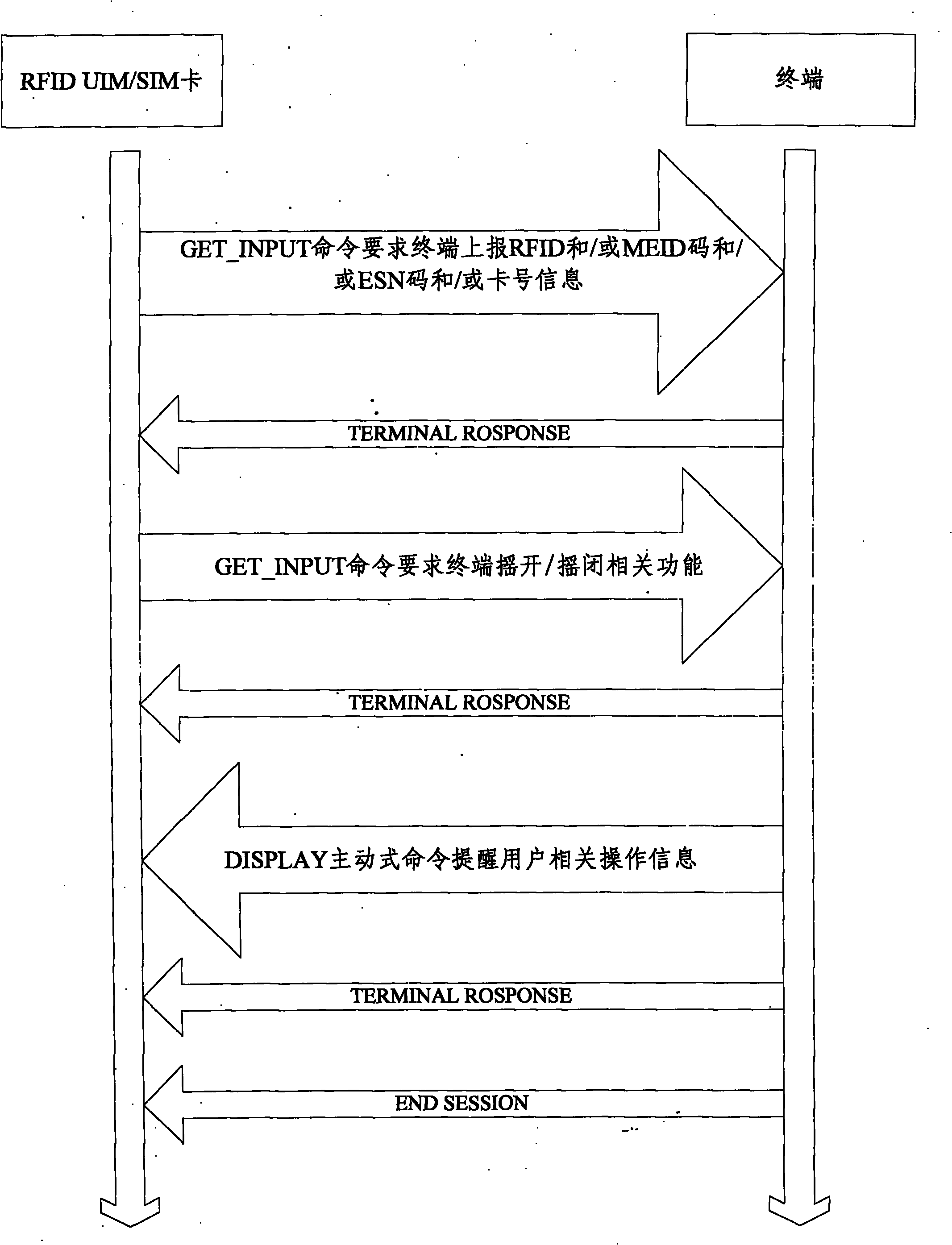

Method for remotely opening and closing radio frequency identification (RFID) user identity module (UIM)/subscriber identity module (SIM) card terminal

InactiveCN102611812AEasy to useRealize remote closingTelephonic communicationSensing record carriersRelevant CommunicationsComputer terminal

The invention relates to a method for remotely opening and closing a radio frequency identification (RFID) user identity module (UIM) / subscriber identity module (SIM) card control terminal, which is characterized by comprising the following steps that: (1) an RFID reader reads the information of an RFID UIM / SIM card; (2) the RFID reader transmits the information to a control server; and (3) the control server judges according to the information and sends a control command to the RFID UIM / SIM card, so as to control the opening and / or the closing of the RFID UIM / SIM card terminal as well as relevant communication functions. According to the method, the special functions of the terminal can be remotely opened and closed on special occasions, so that the use by a user is convenient.

Owner:微网信通(北京)通信技术股份有限公司

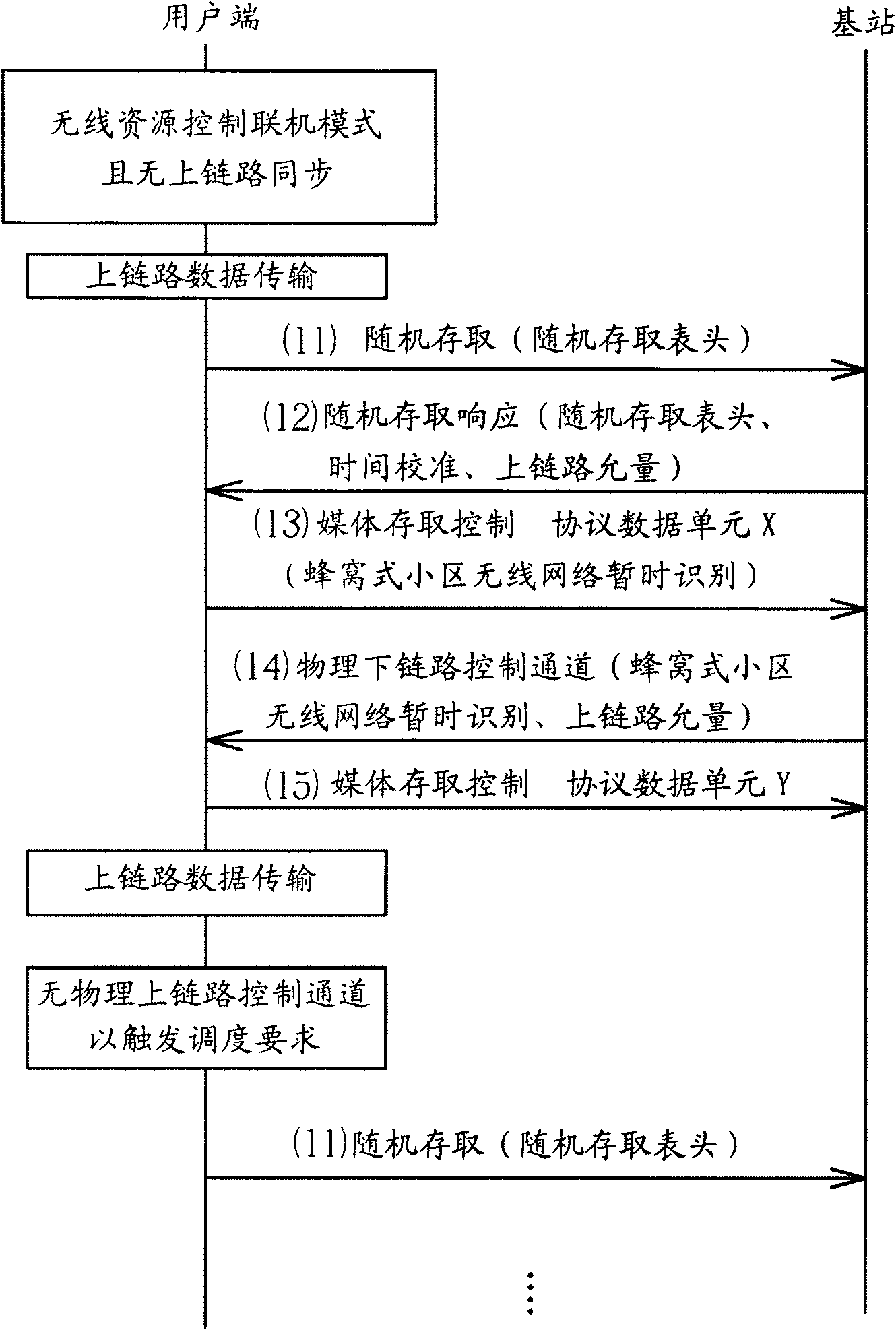

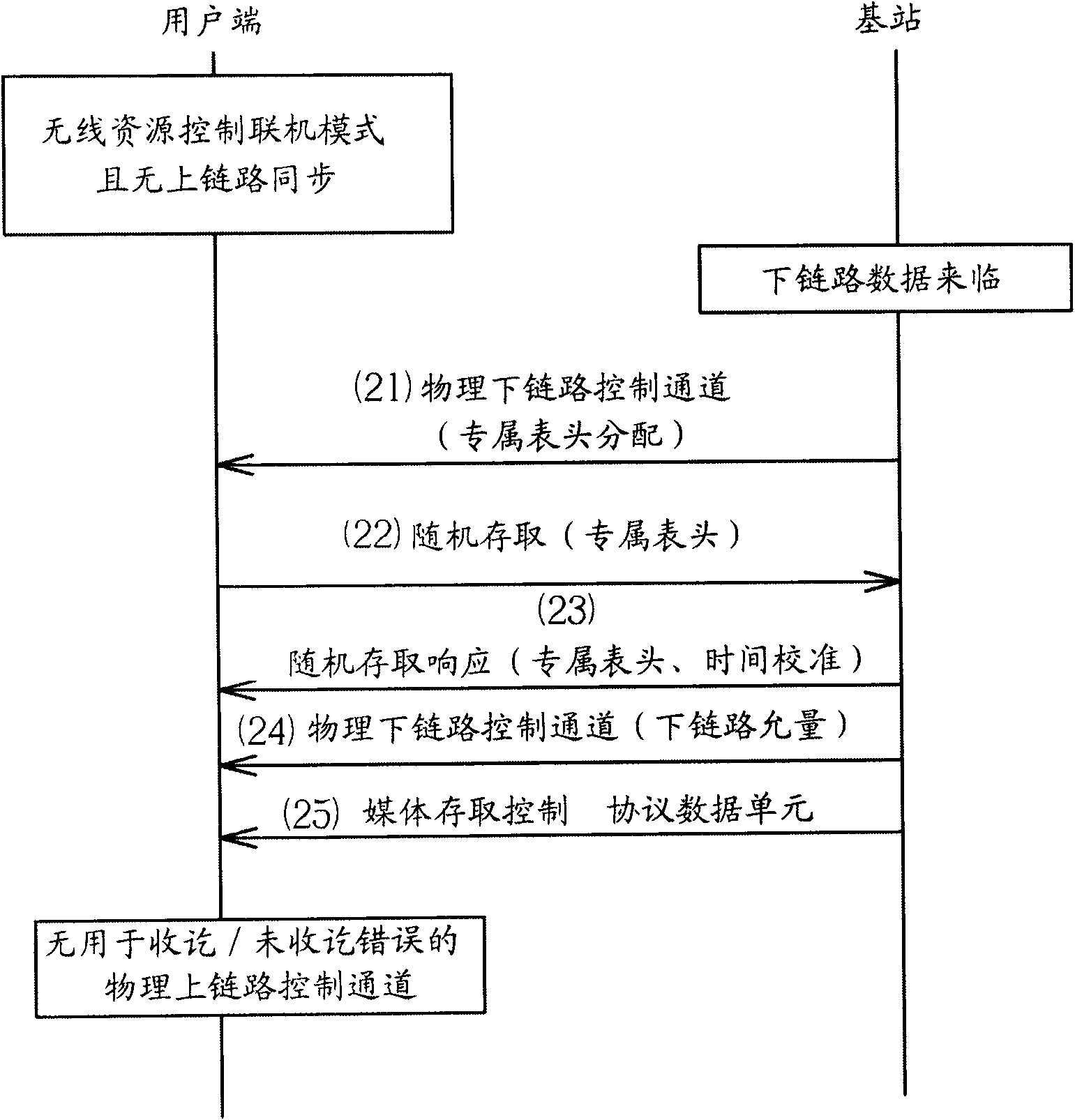

Method of improving uplink signaling transmission for a user equipment of a wireless communication system

InactiveCN101686489AWith transmission capabilityNetwork traffic/resource managementTransmission path divisionCommunications systemRelevant Communications

The invention provides a method of improving uplink signaling transmission for a user equipment of a wireless communication system. The method includes performing a random access procedure, and applying resources of a physical uplink control channel and an uplink symbol used for channel quality determination when a message of the random access procedure received from a network of the wireless communication system is performed successfully.

Owner:HTC CORP

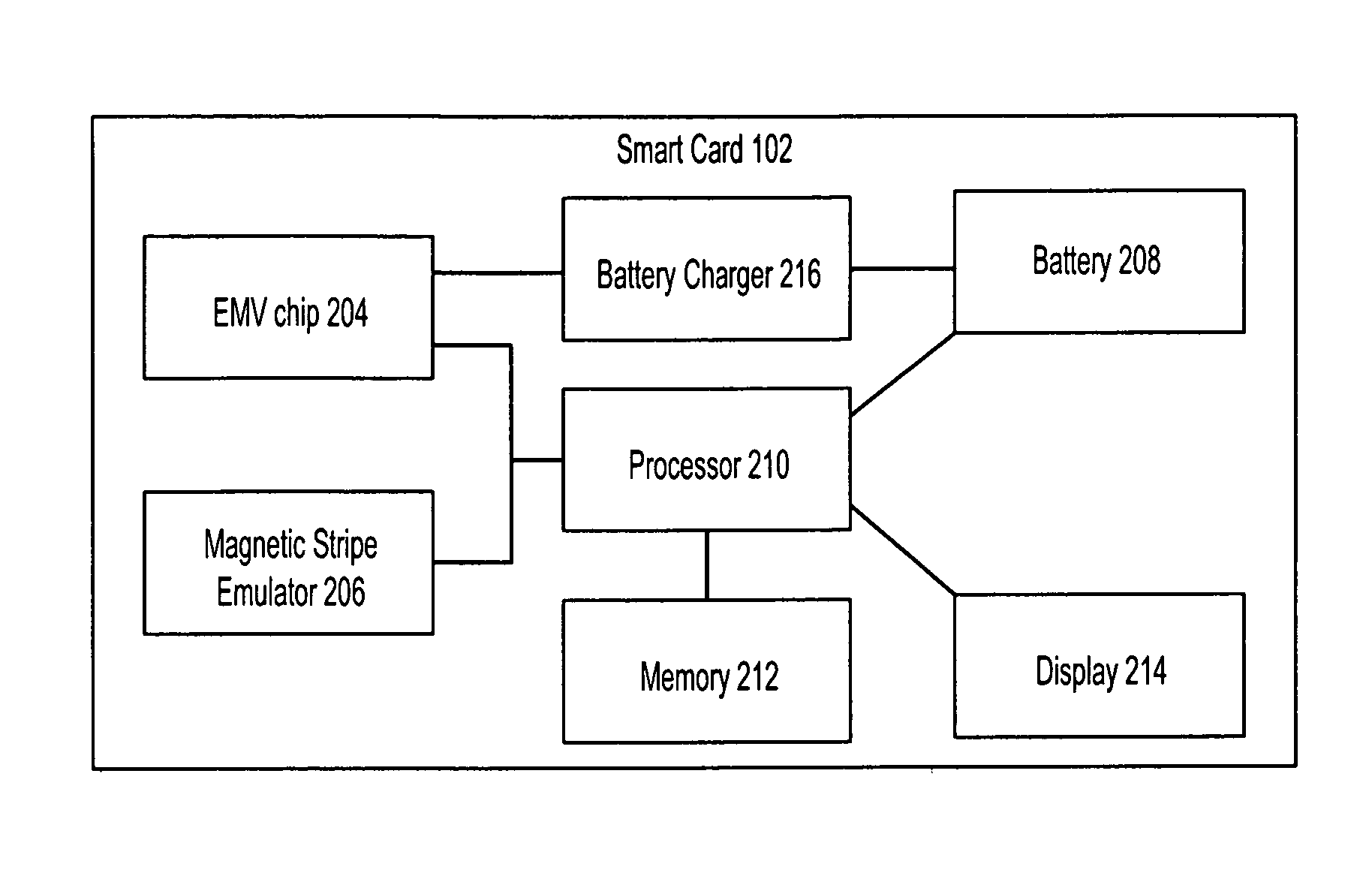

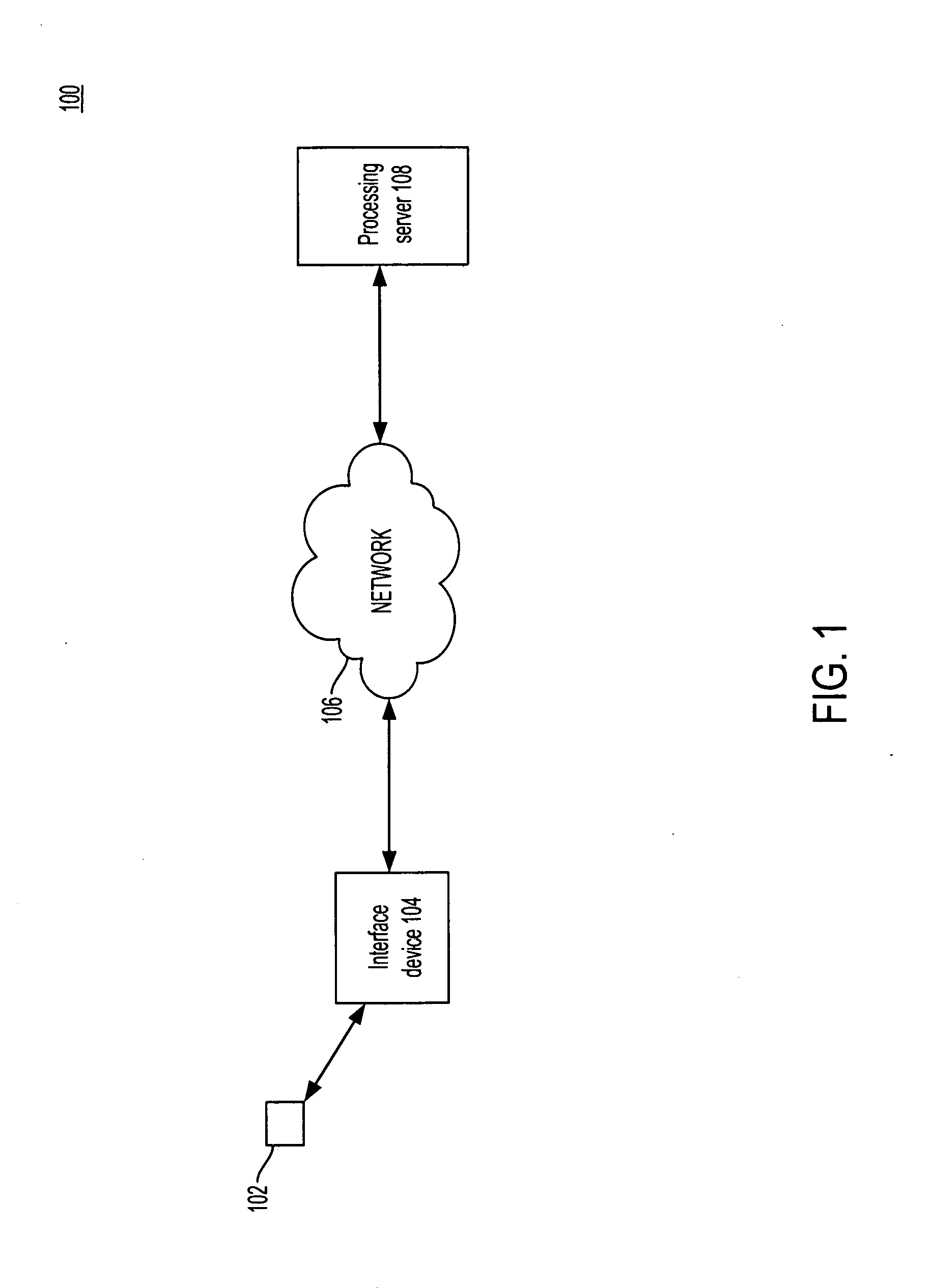

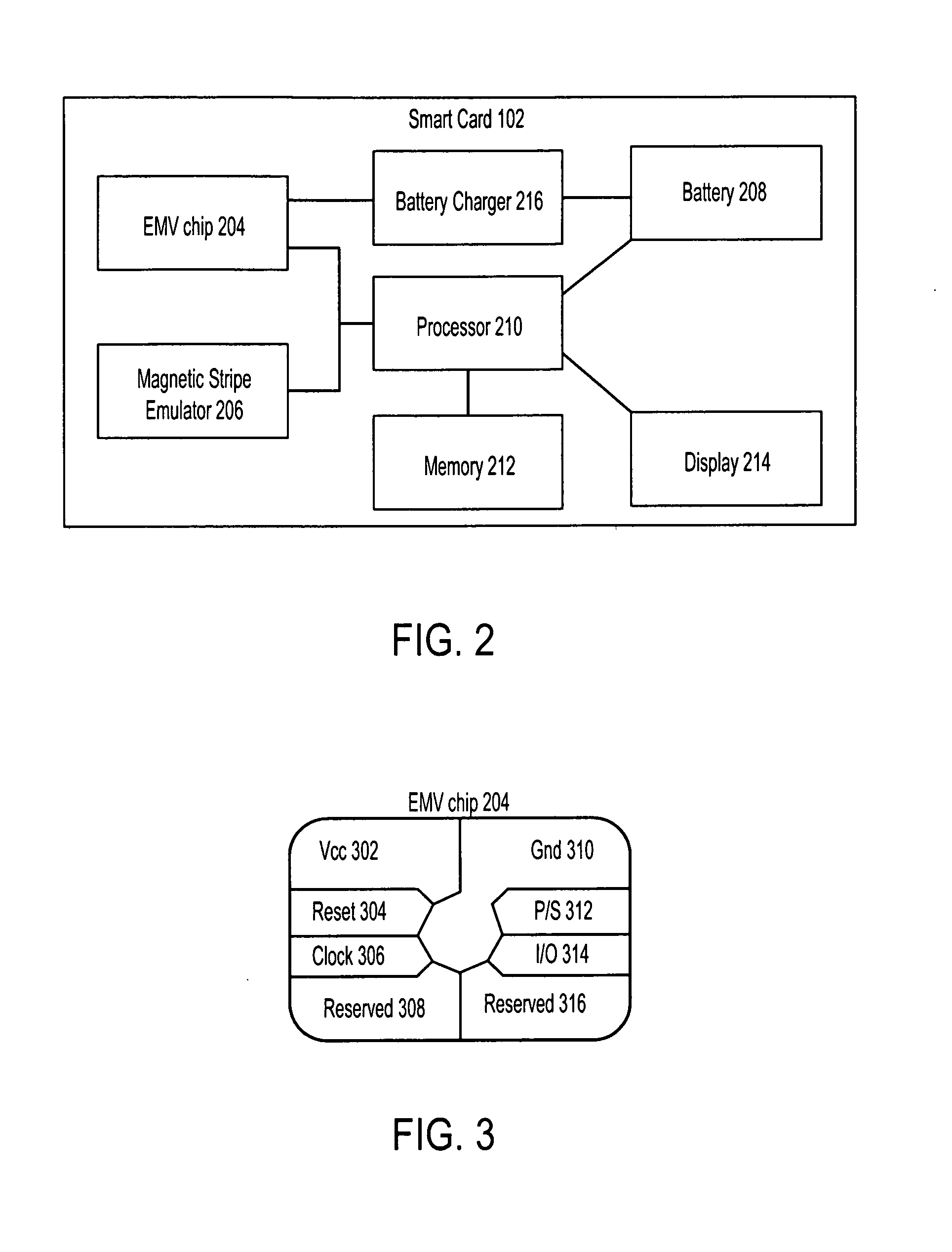

Smart card battery charging during card use

Systems, methods, and computer program products are disclosed for dynamically charging an internal battery of a smart card from an interface device (such as a terminal) so that the battery life may be extended. A smart card device detects that it has interfaced with an interface device and that voltage is now being provided to the smart card device. The smart card device may divert some or most of the current being provided with the voltage to charge an internal battery of the smart card device, either concurrent to other communications between the smart card device and the interface device or before / after relevant communications are completed. As a result, the use of a smart card device contributes to the charge of the smart card device's internal battery, instead of draining it.

Owner:PAYPAL INC

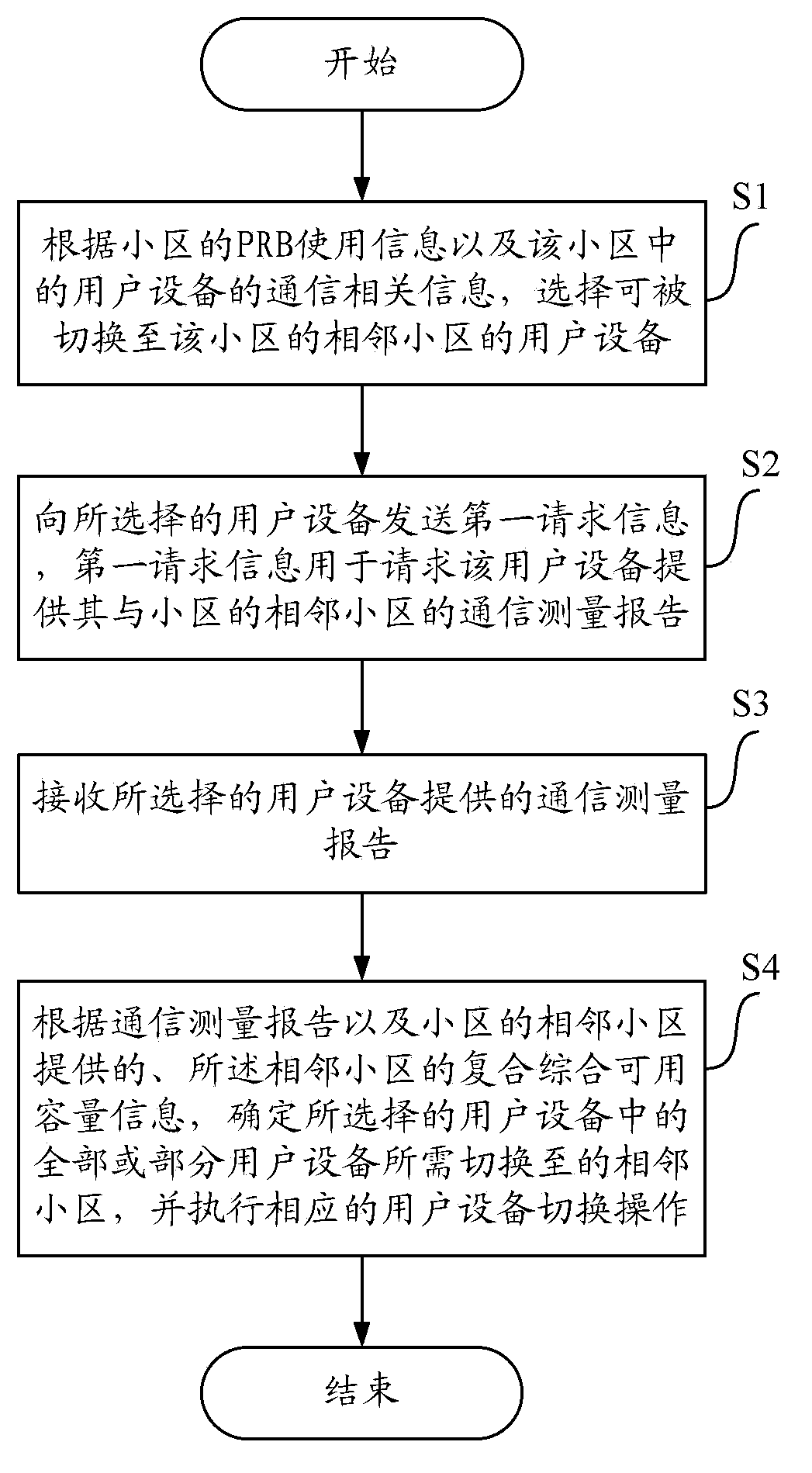

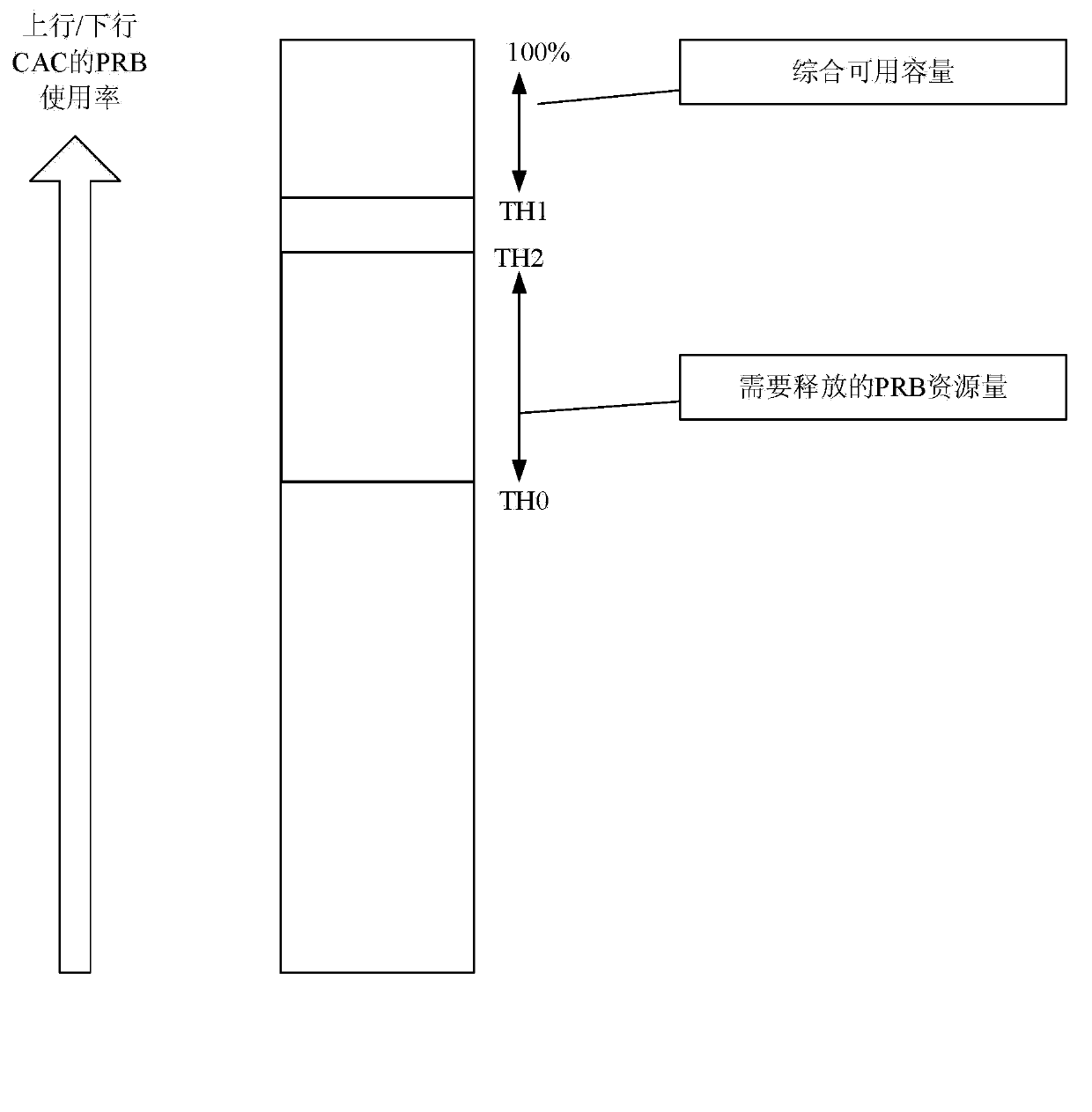

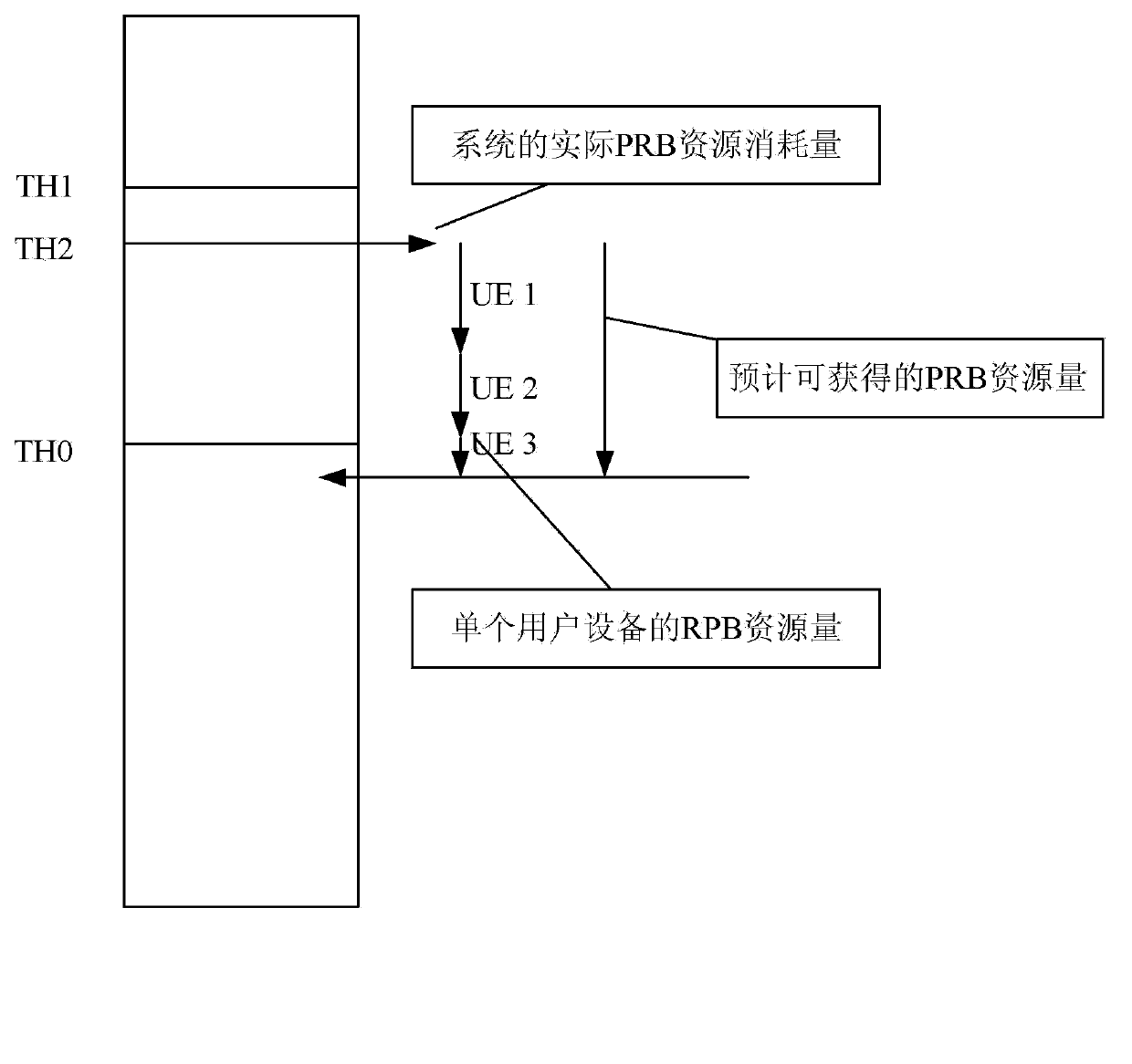

Method and device for switching user equipment

ActiveCN103874142ALower quality of serviceReduce processing loadConnection managementQuality of serviceResource block

The invention provides a method and a device for switching user equipment from a cell to a neighboring cell. The method comprises the following steps of according to PRB (physical resource block) use information of the cell and the relevant communication information of the user equipment in the cell, selecting the user equipment which can be switched to the neighboring cell; sending first request information to the selected user equipment; receiving a communication measuring report provided by the selected user equipment; according to the communication measuring report and the comprehensive available capacity information provided by the neighboring cell, determining the required neighboring cell for switching of all or part of the selected user equipment, and executing the corresponding switching of the user equipment. The method and the device can reduce the possibility of degrading of service quality when the selected user equipment is switched to the neighboring cell, and the possibility of failure of switching when the selected user equipment is refused by the neighboring cell.

Owner:ALCATEL LUCENT SHANGHAI BELL CO LTD

Method of managing discontinuous reception offset in a wireless communications system and related communication device

ActiveCN101730219ASynchronisation arrangementConnection managementCommunications systemRelevant Communications

A method of managing an offset operation of discontinuous reception, hereinafter called DRX, for a mobile device of a wireless communication system includes separately managing a start offset operation of a long DRX cycle and a start offset operation of a short DRX cycle.

Owner:HTC CORP

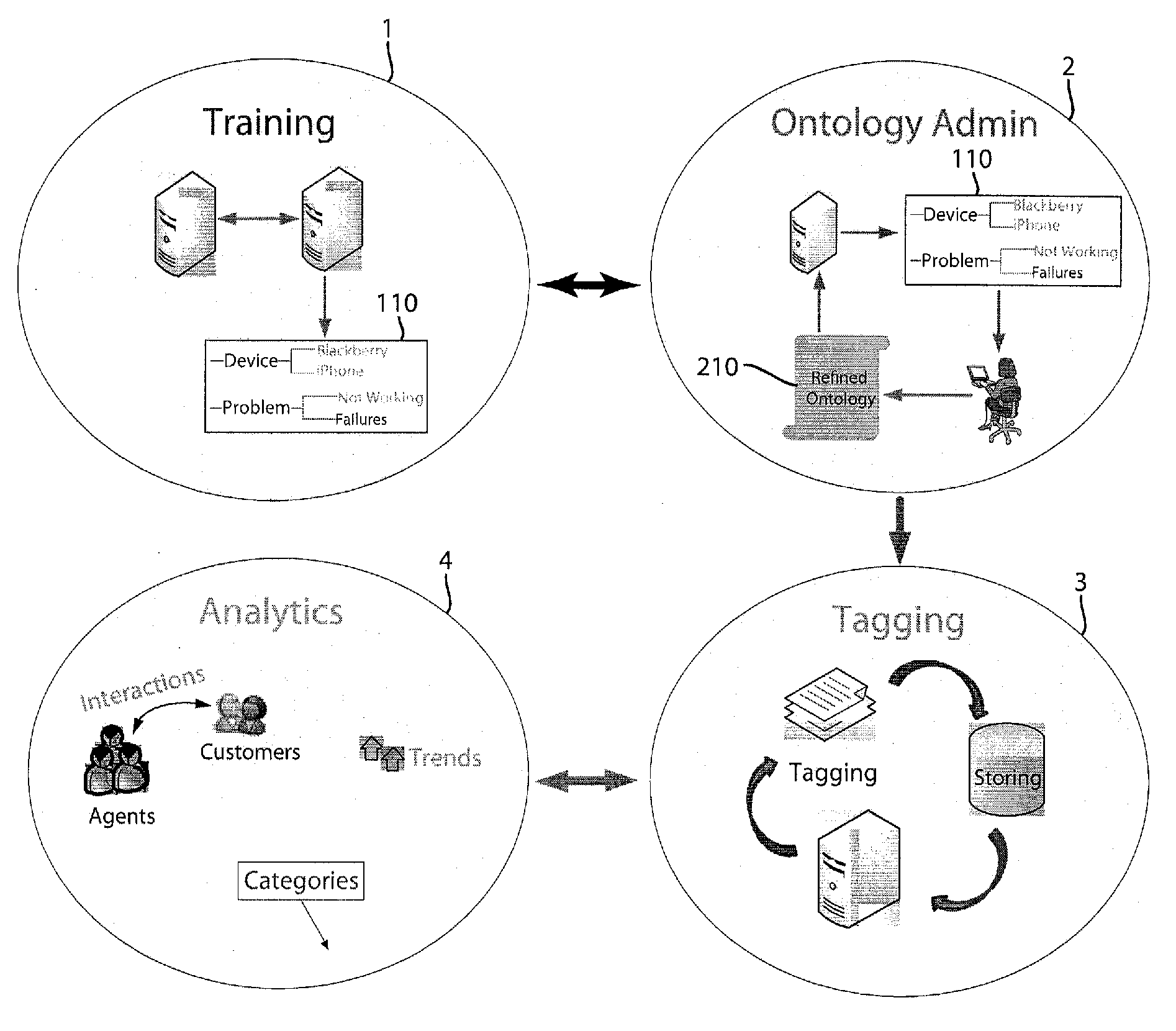

Call summary

ActiveUS20150220630A1Faster and more streamlinedDigital data information retrievalDigital data processing detailsSubject matterRelevant Communications

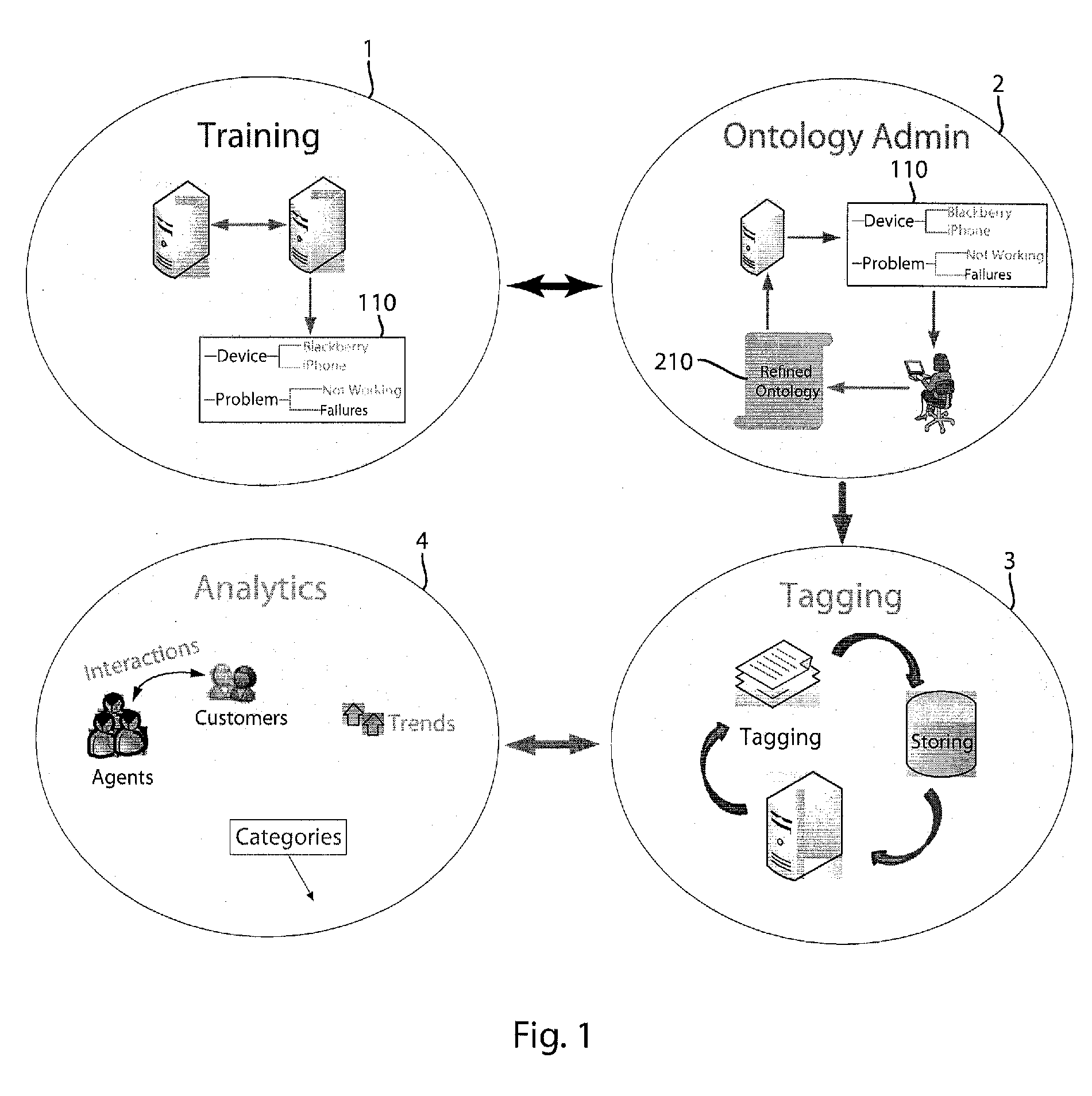

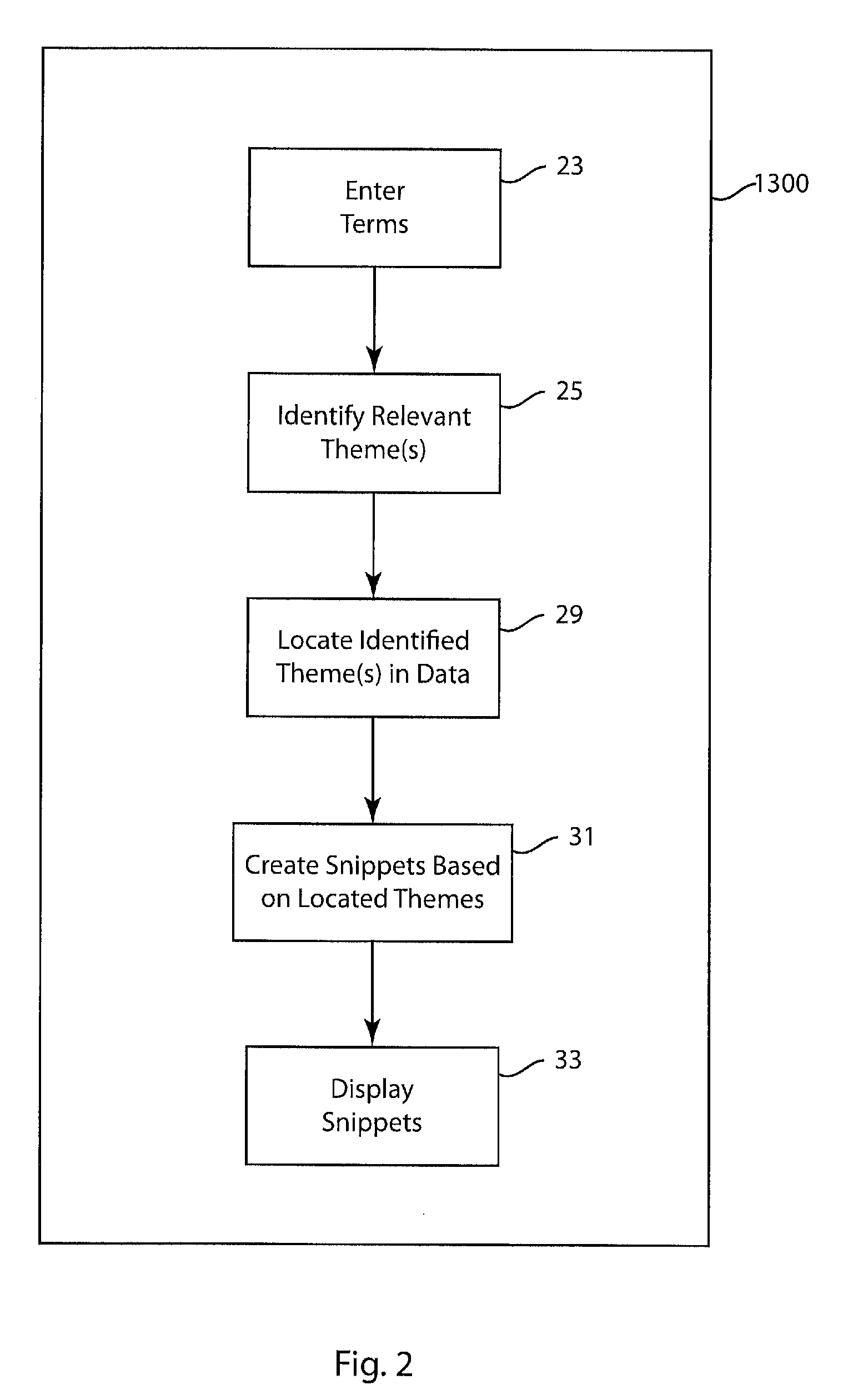

A faster and more streamlined system for providing summary and analysis of large amounts of communication data is described. System and methods are disclosed that employ an ontology to automatically summarize communication data and present the summary to the user in a form that does not require the user to listen to the communication data. In one embodiment, the summary is presented as written snippets, or short fragments, of relevant communication data that capture the meaning of the data relating to a search performed by the user. Such snippets may be based on theme and meaning unit identification.

Owner:VERINT SYST INC

Method and apparatus for operation, protection, and restoration of heterogeneous optical communication networks

Techniques for providing normal operation and service restoration capability in the event of failure of terminal equipment or transmission media in a heterogeneous network, such as a hybrid network containing single- and multi-wavelength lightwave communications systems. An optical switching node (OSN) is placed at each node in the ring network to provide the required connections between various fibers and terminal equipment, but having switch states that allow signals on the protection fibers to bypass the terminal equipment at that node. Ring-switched signals propagate around the ring on protection fibers without encountering the terminal equipment at the intervening nodes. To the extent that the protection fiber links between any given pair of nodes are incapable of supporting all the relevant communication regimes, such links are modified to provide such support.

Owner:CIENA

System and method for relevant business networking based in controlled relevancy groups, responsibilites and measured performance

ActiveUS9117196B2Meaningful and relevant business connectionReduce inhibitionMultiple digital computer combinationsOffice automationRelevant informationRelevant Communications

A business networking system and method for groups of people within a variety of business types to organize themselves into specific and relevant categories in order to maximize the exchange of relevant information and further development of relevant business contacts. The method and system offer tools for registering members and sub-dividing those registered members into smaller relevant groups. The method matches members of similar backgrounds and business experiences and provides communications, messaging and meetings for relevant. The system provides tools to encourage reciprocal relevant communications, both online and in the real world, between members. All activity is tracked and grouped into a plurality of statistics that are then ranked and shared with members. The statistics are used by the TBS system as a scorecard or as punishment in the form of expulsion from the categorized group.

Owner:BOARDSEAT

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com