Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

115 results about "Stock trading" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

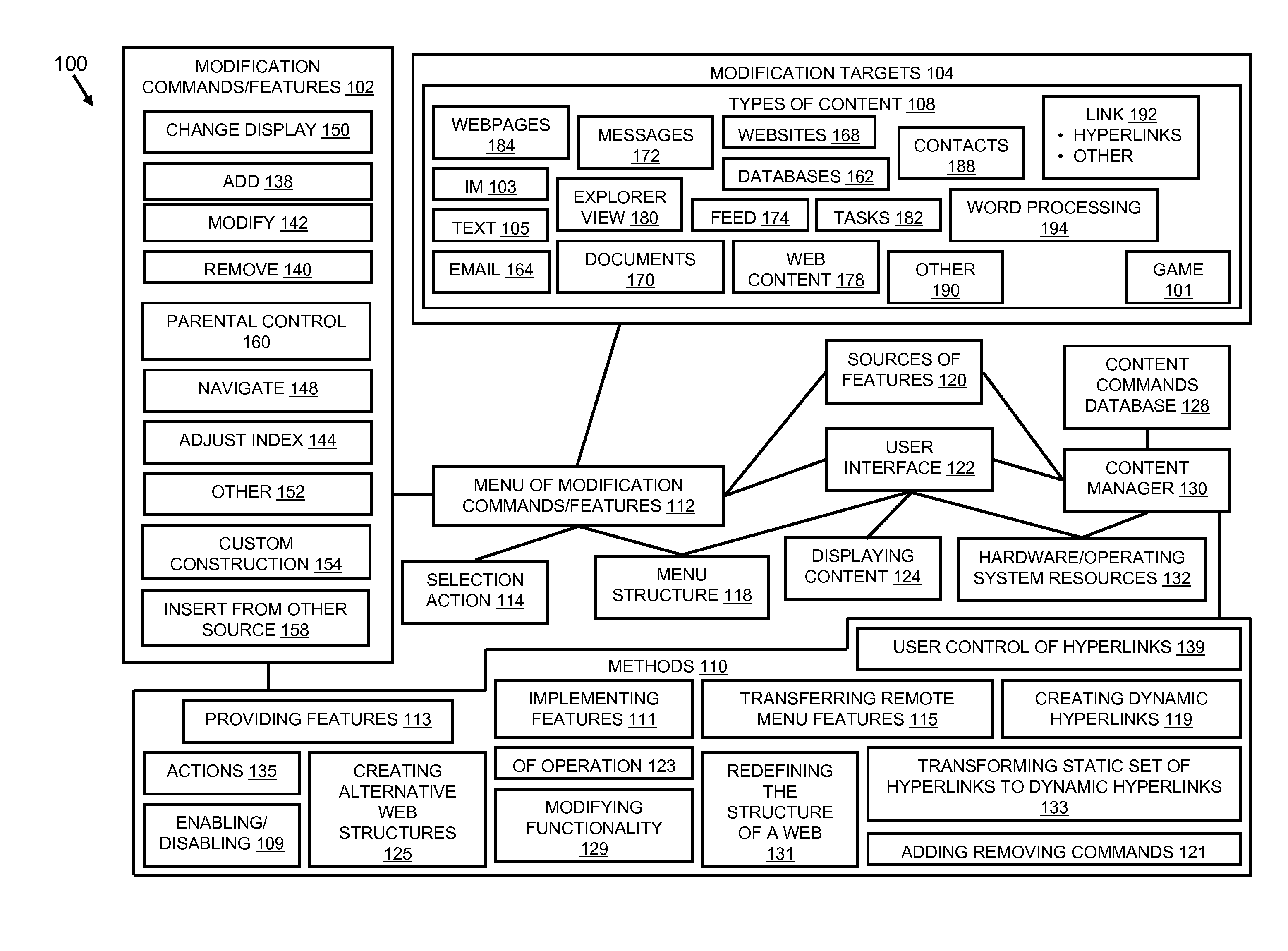

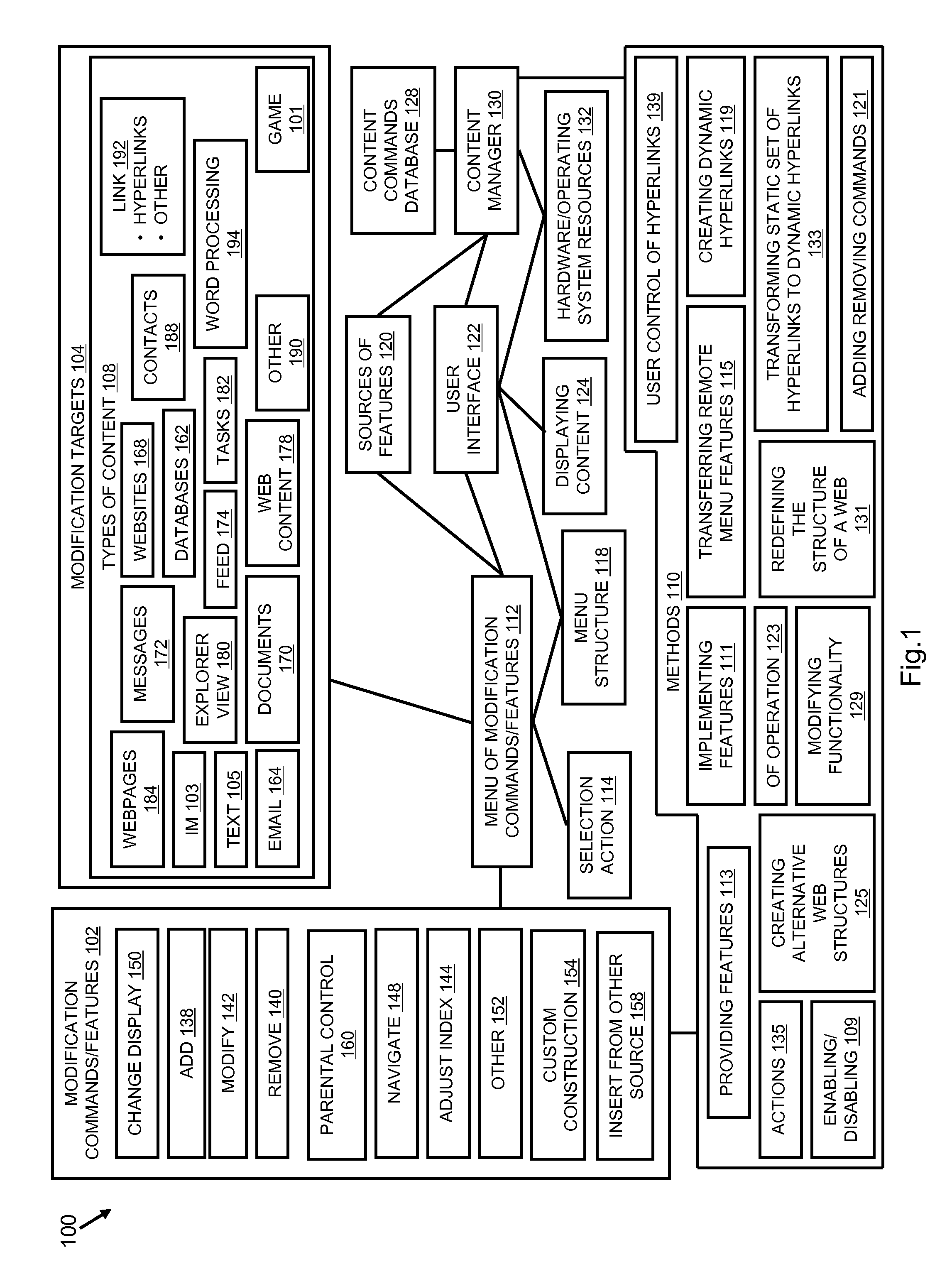

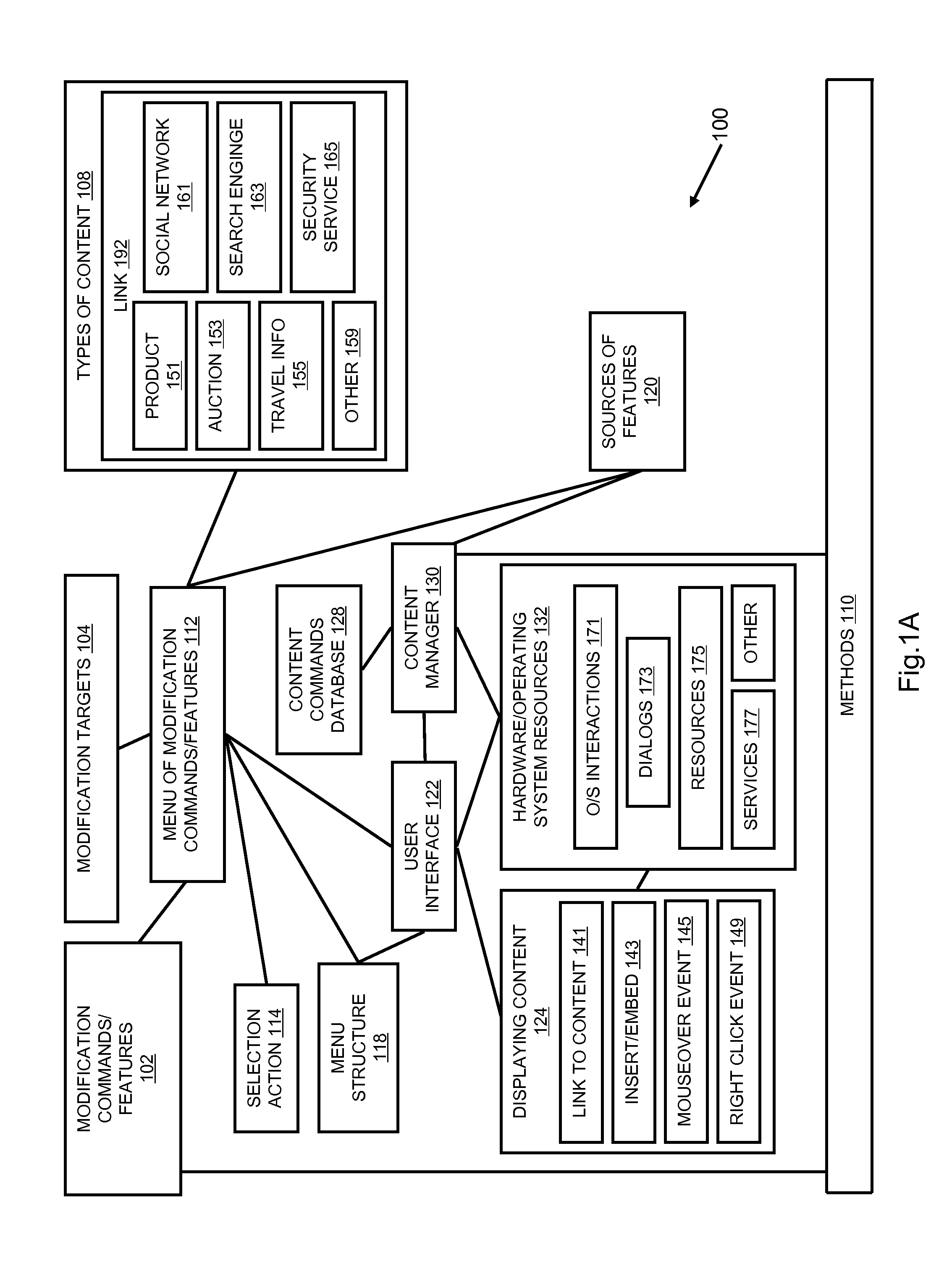

Personalized content control

InactiveUS20070208751A1Improve customizationOffice automationSpecial data processing applicationsPersonalizationThe Internet

A content modification platform facilitates personalized presentation and interaction associated with content such as web content, document content, transactional content, multimedia content, and the like. The platform provides sharing of personalization features to facilitate developing a community view of content, such as the internet Menu features are configured to modify source content through simple commands such as add, delete, replace targeted toward content and links to content. The content modification platform is beneficially and effectively used in a variety of on-line content types, environments, transactions, business activity, e-commerce, stock trading, education, human resources and many others. By facilitating a user defining what relationships between and among content is important to them, a customized view of the internet can be presented to the user.

Owner:GROUPON INC

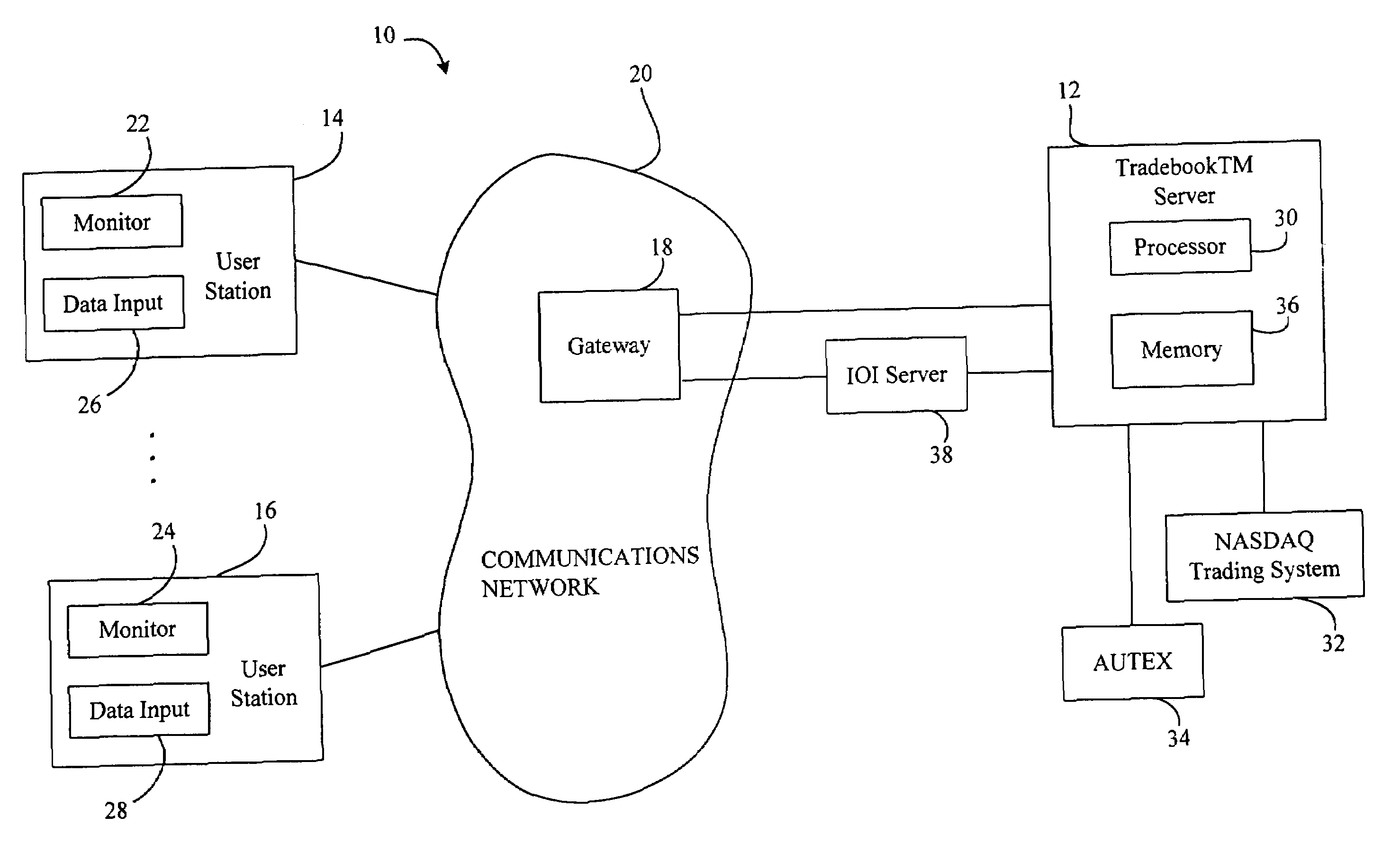

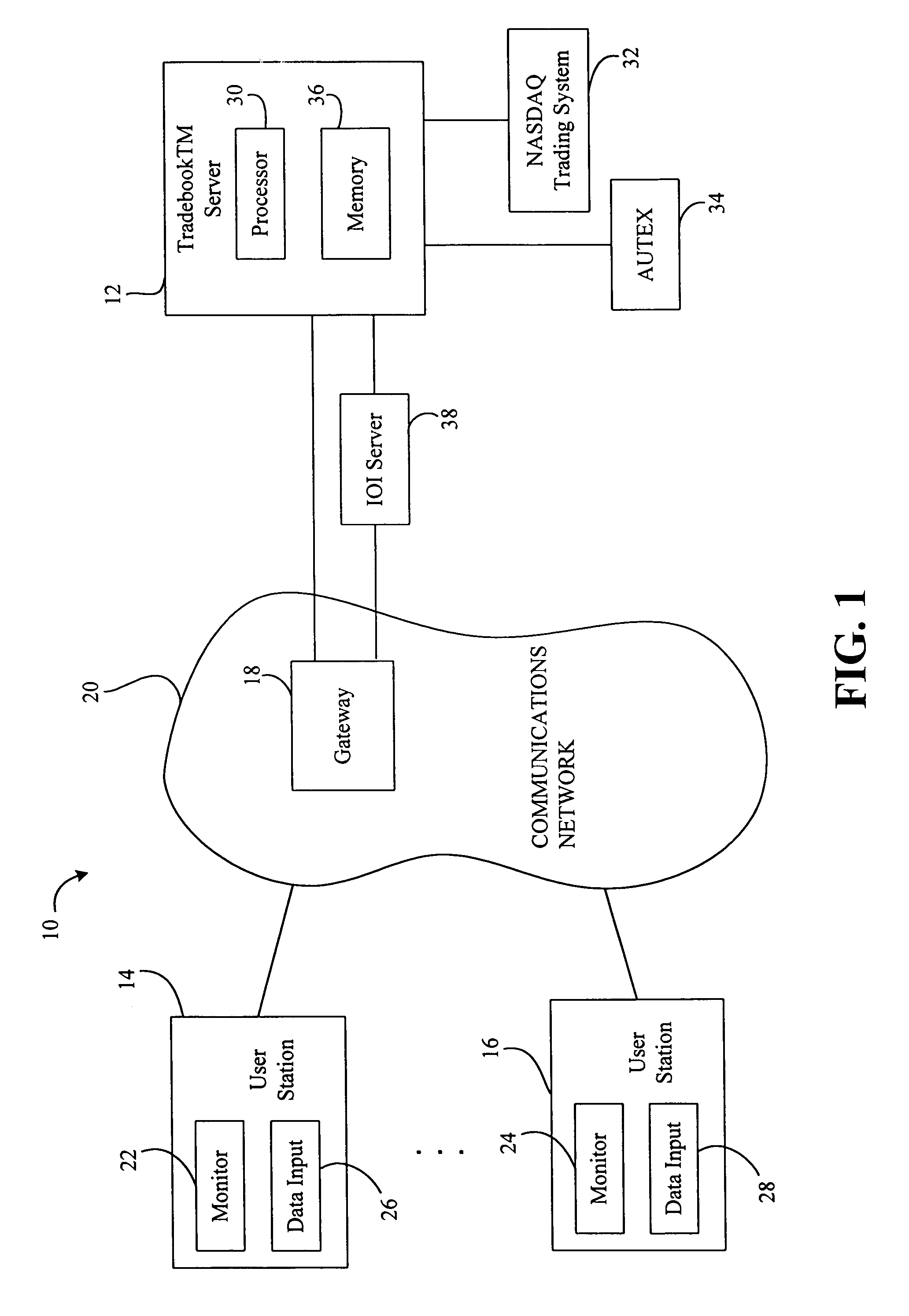

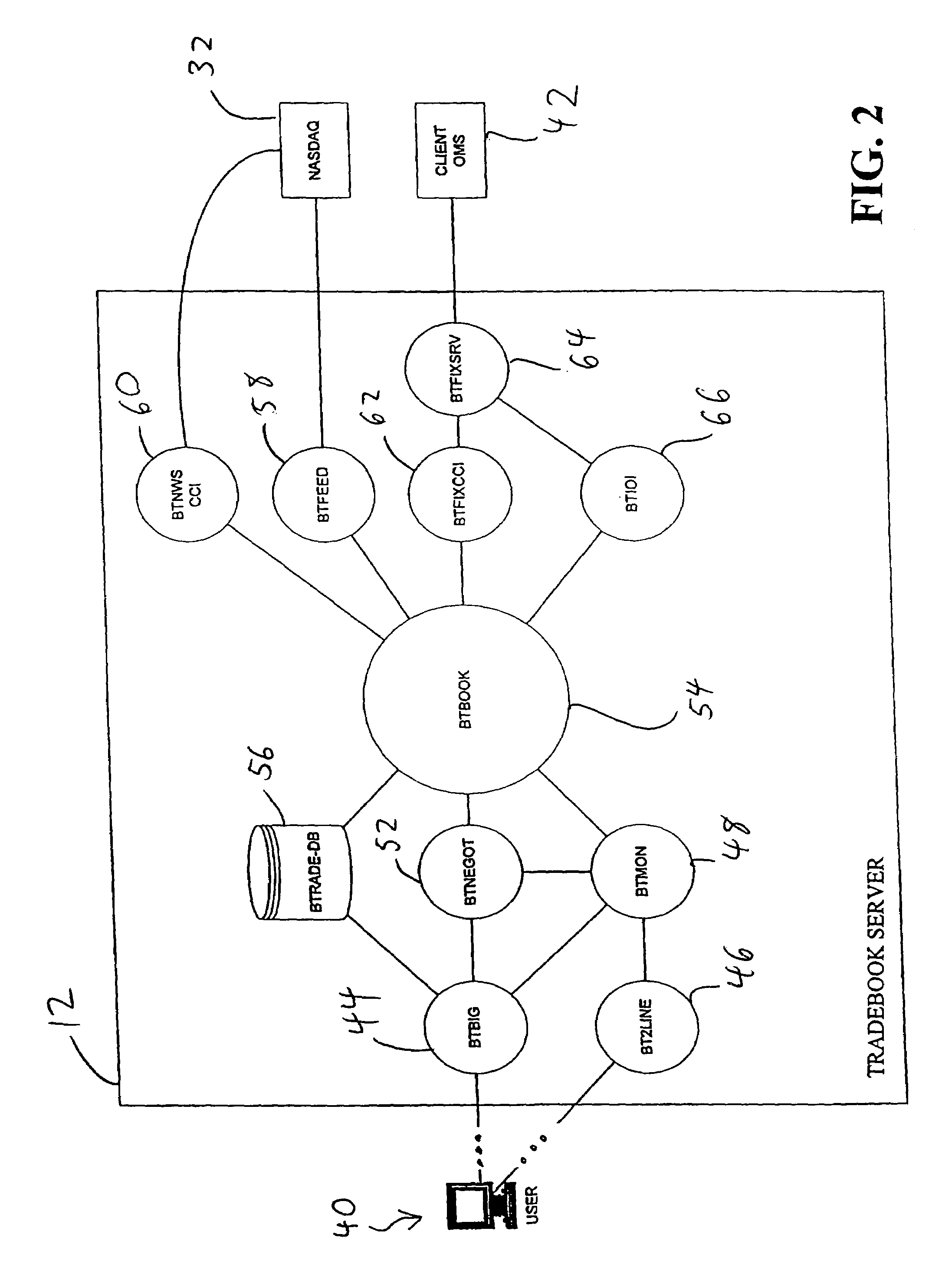

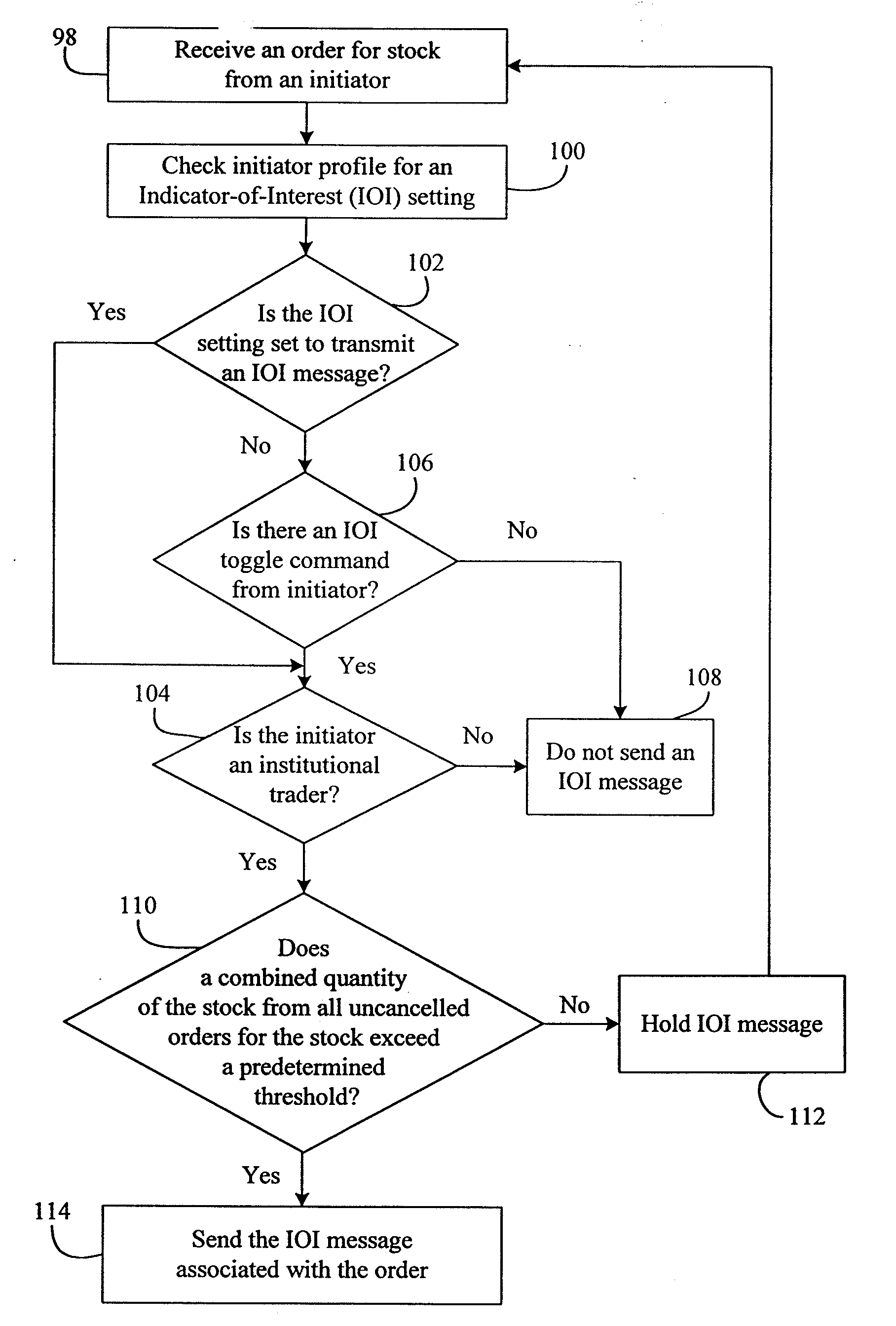

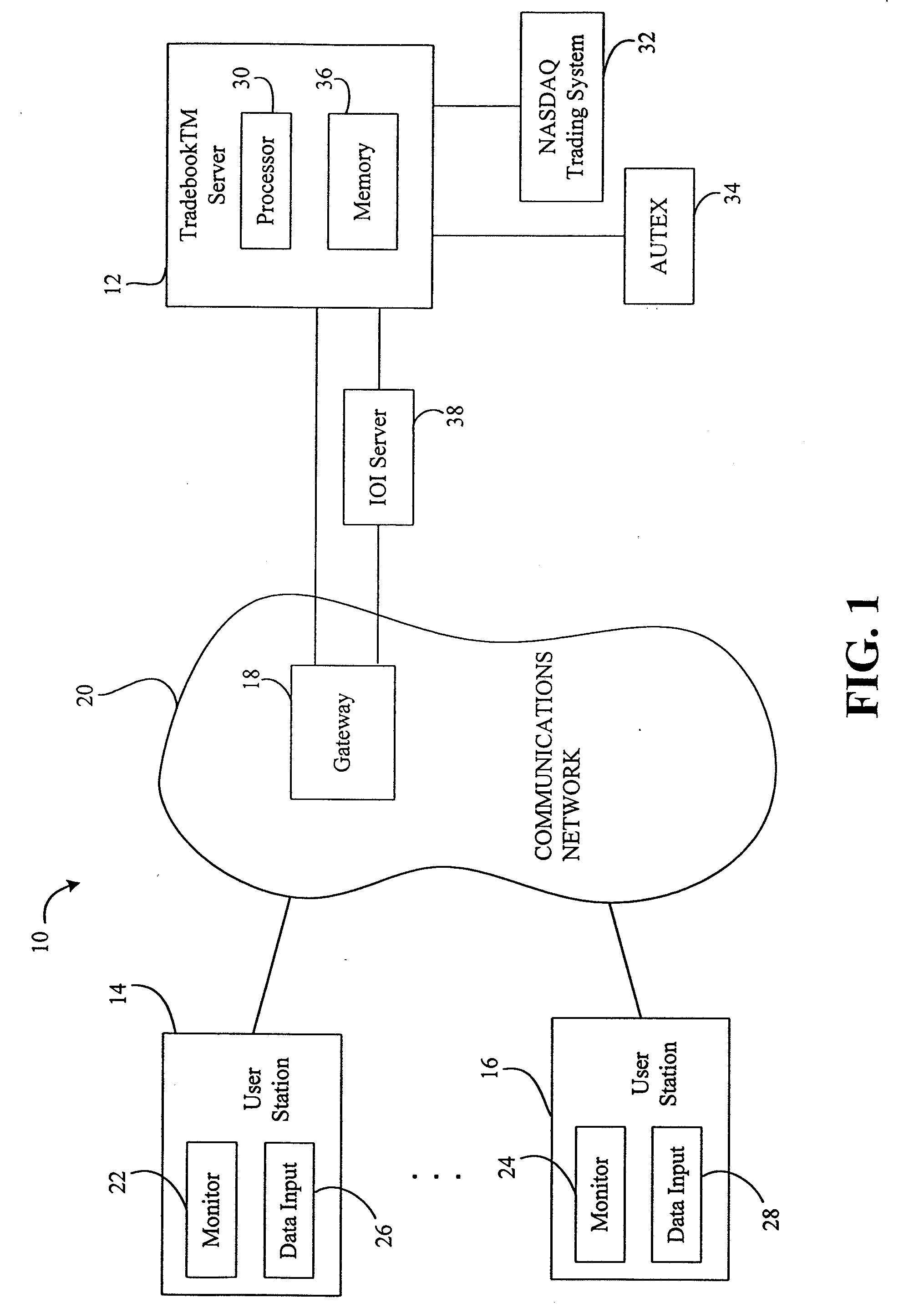

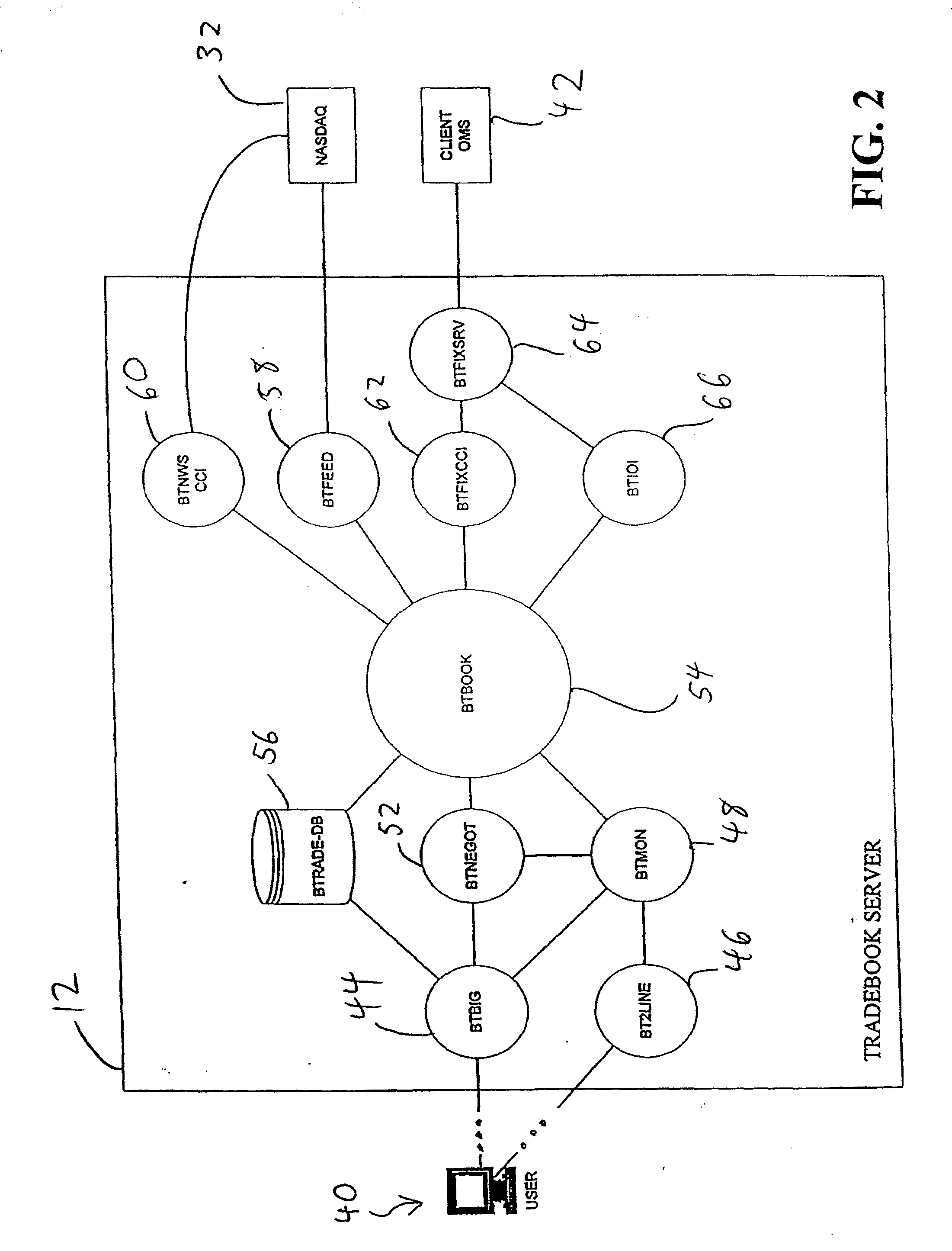

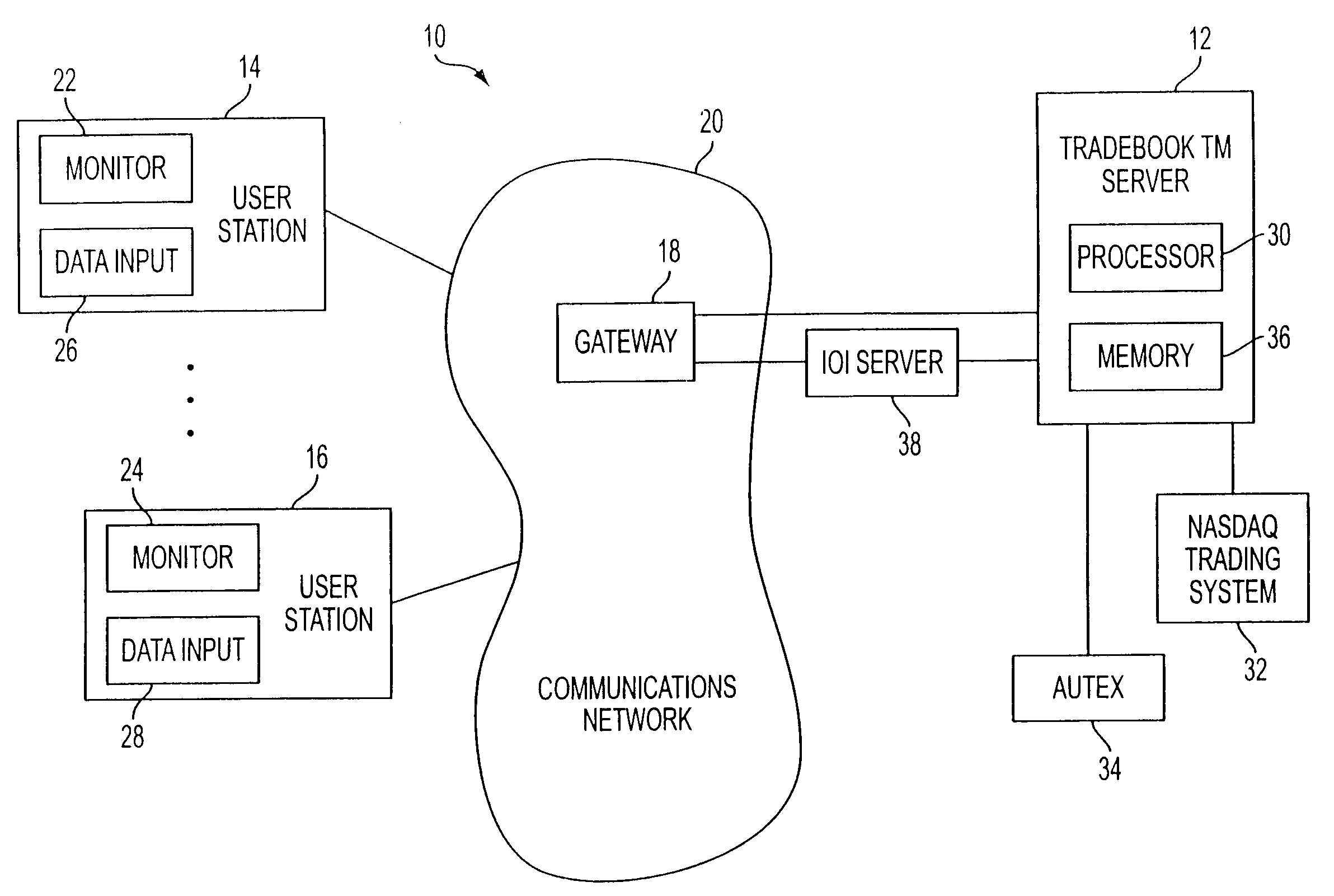

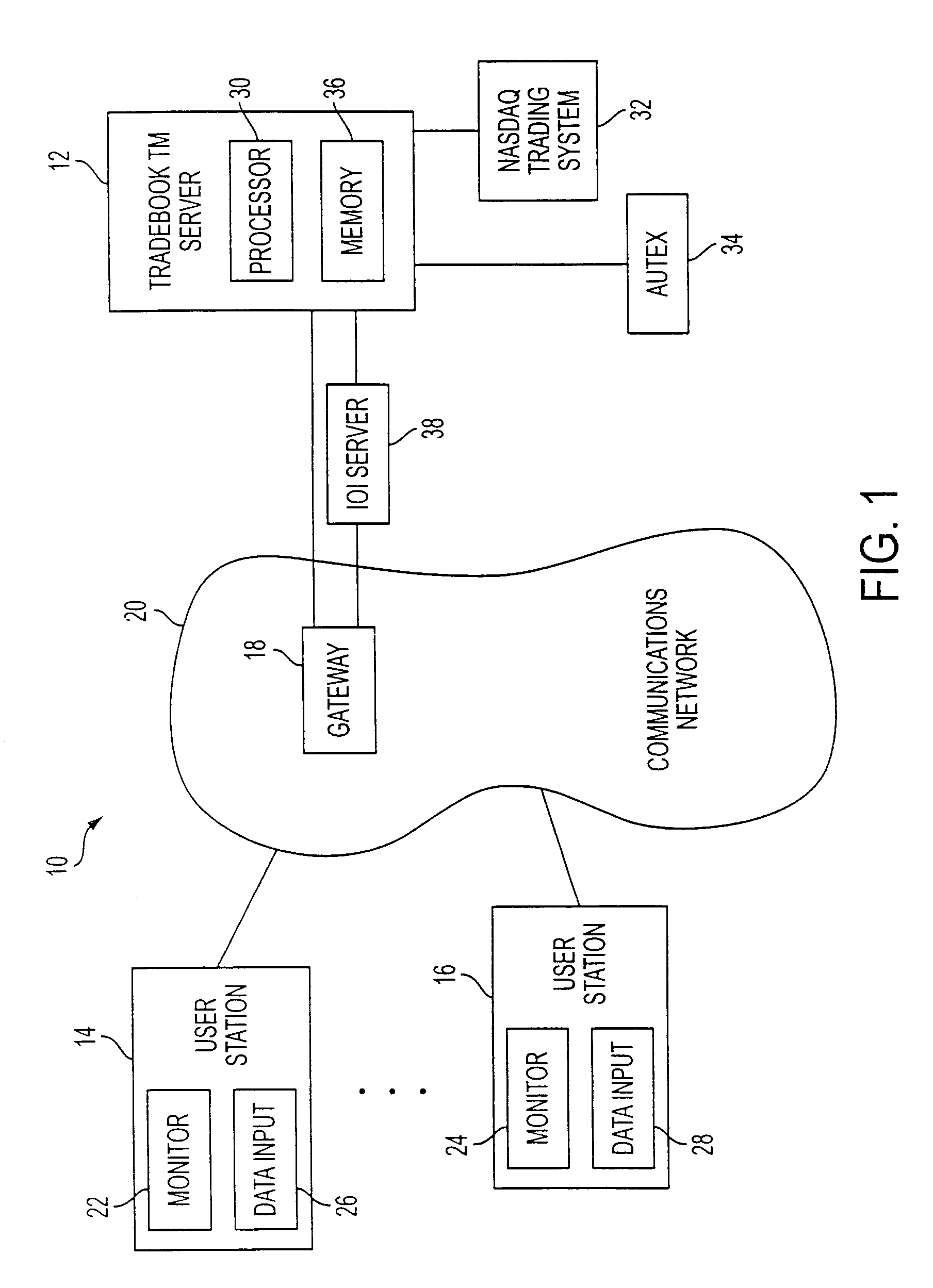

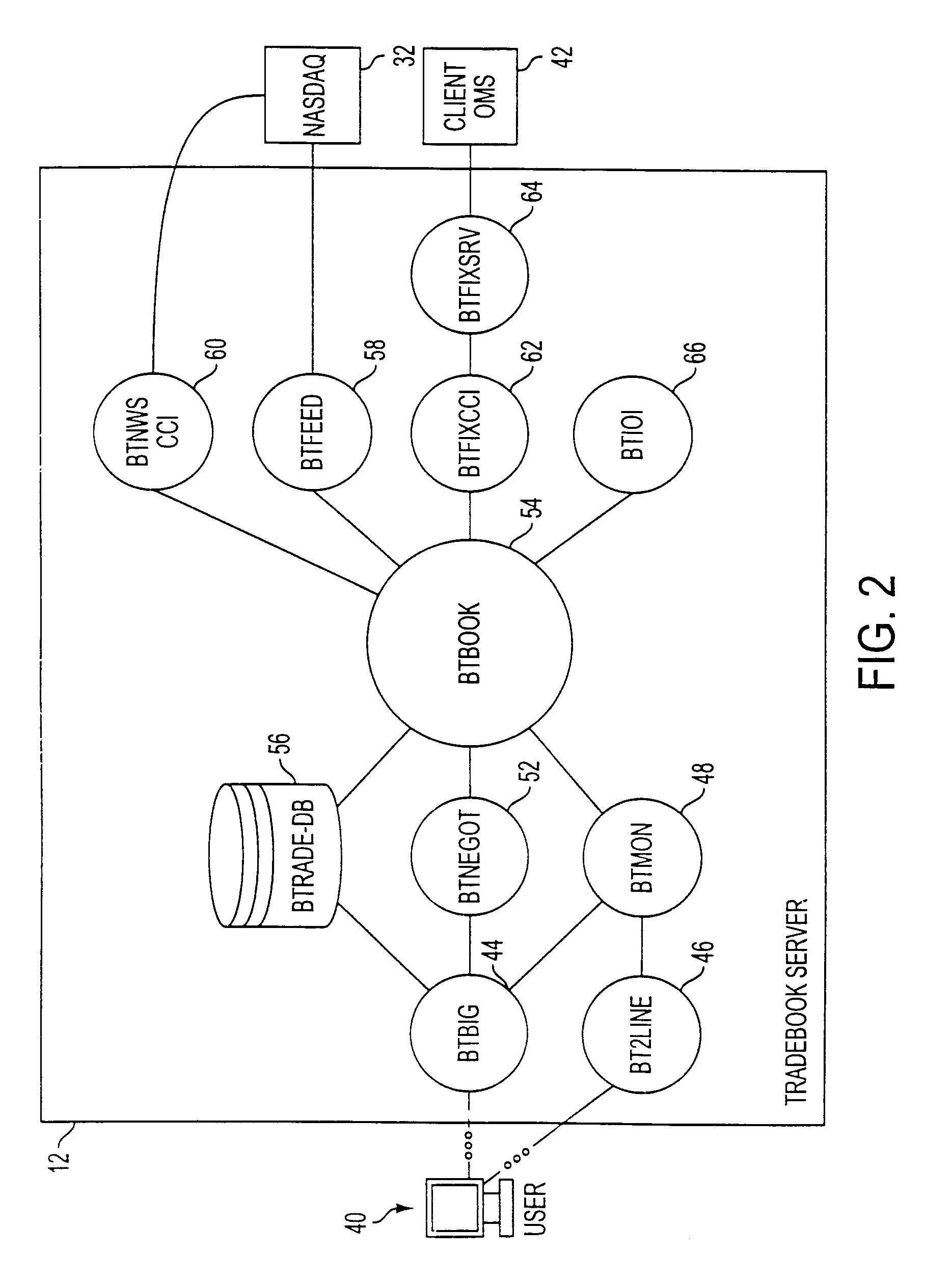

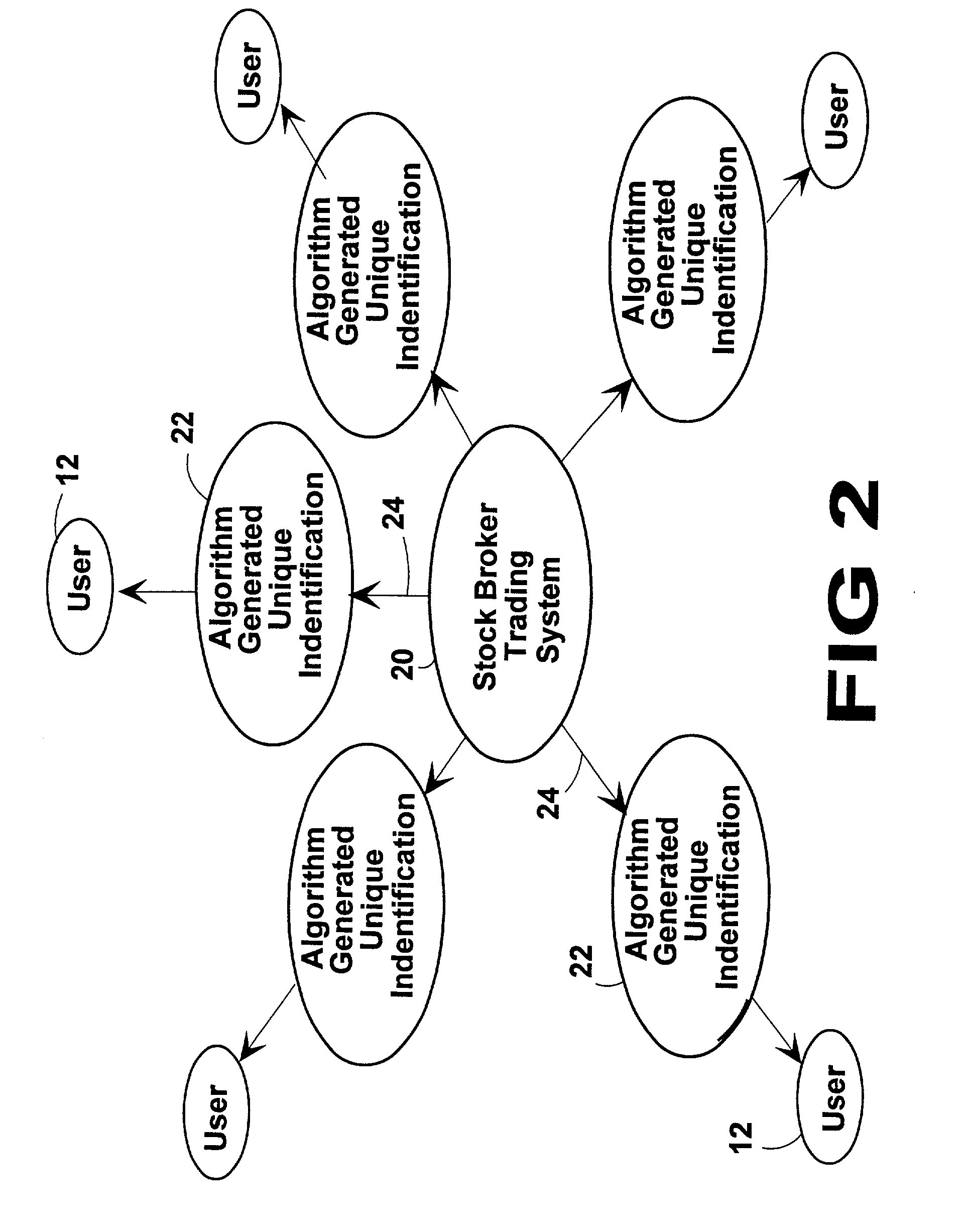

Electronic trading system supporting anonymous negotiation and indications of interest

Owner:BLOOMBERG

Electronic Trading System Supporting Anonymous Negotiation And Indicators Of Interest

A system conducts anonymous negotiations and supports indications-of-interest in trading stock. The system includes a database for storing public orders received from a public stock trading system; and a server for receiving hidden orders from a plurality of users and for conducting anonymous negotiations between first and second users with the hidden orders. The server repeatedly accesses the database to determine a match of any one of the hidden orders with any one of the public orders, and to execute a pair of orders selected from the hidden orders and the public orders. The system also transmits indicators-of-interest (IOIs) into a trading environment using the server for processing a trading order from a first user and for maintaining a profile of a user. The profile includes a current IOI setting for controlling transmission of the IOI from the user. The server responds to a toggle command from the first user to control transmission of the IOI opposite to the current IOI setting. The server responds to the IOI setting being set to allow transmission by transmitting the IOI of the first user associated with the trading order.

Owner:BLOOMBERG

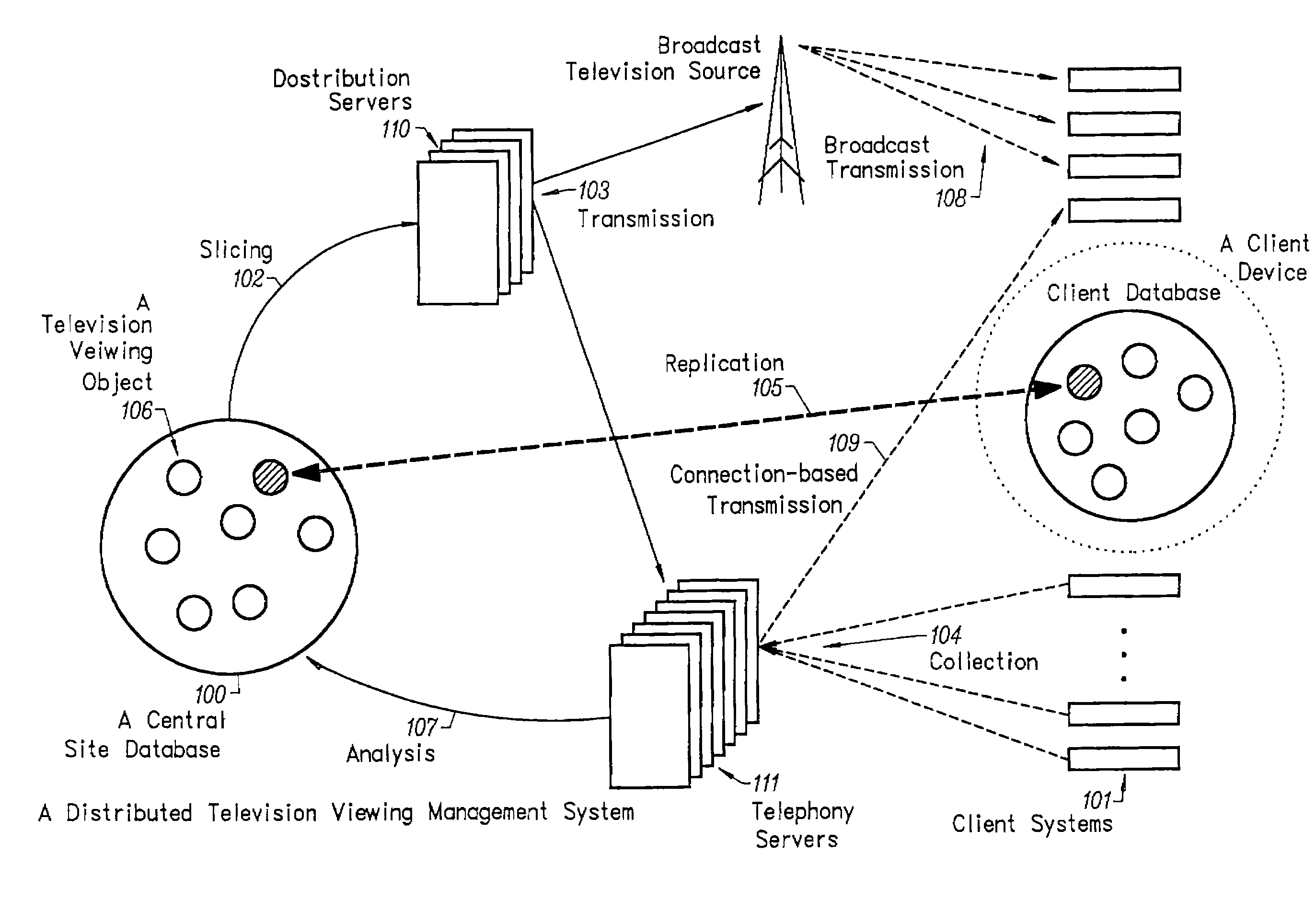

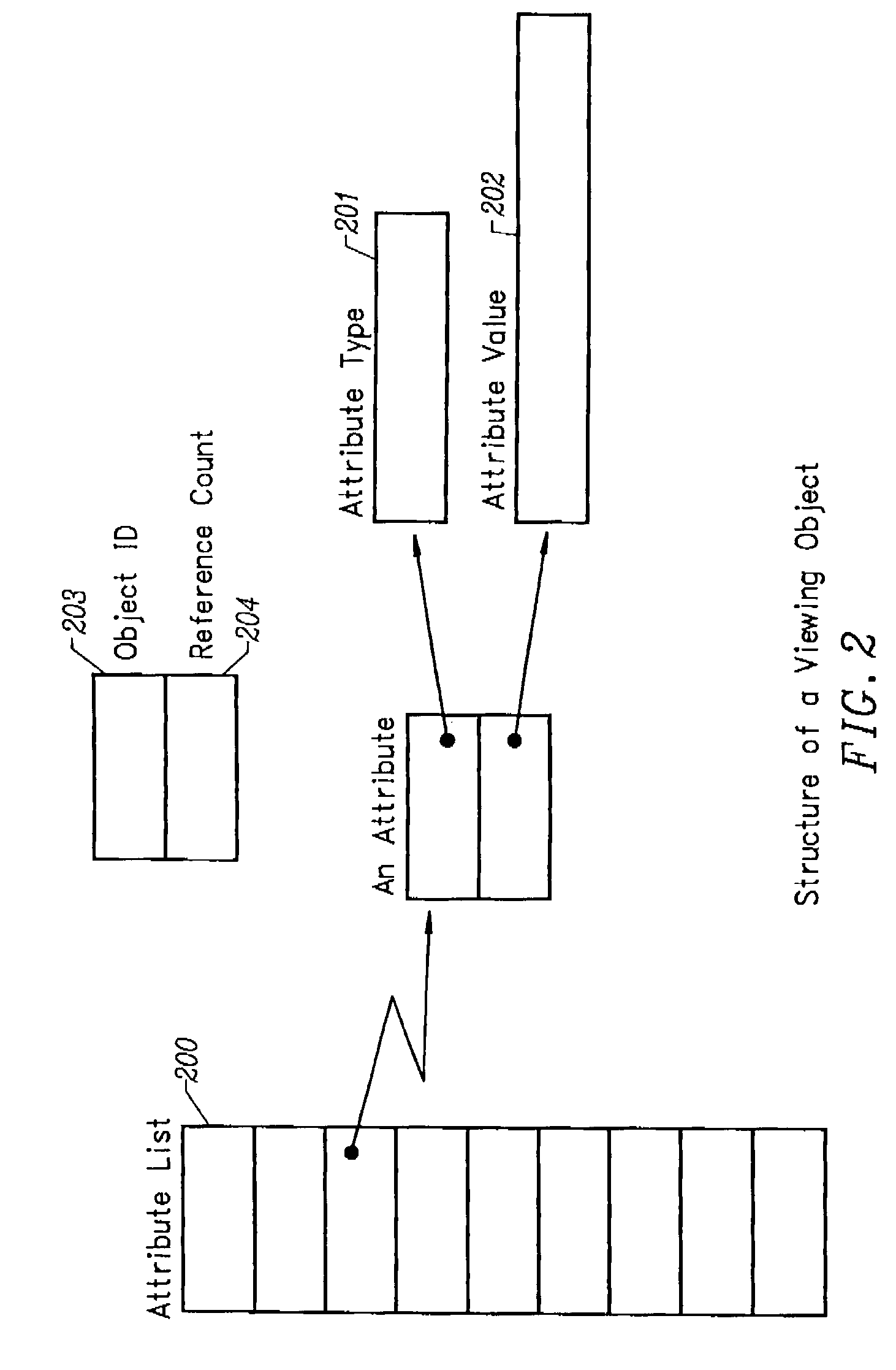

Electronic content distribution and exchange system

InactiveUS8131648B2Secure distributionTelevision system detailsAnalogue secracy/subscription systemsBroadcast channelsServer log

An electronic content distribution and exchange system provides authenticated, reliable content downloads and tracking capabilities. Content is distributed to users through the invention's architecture. A user registers for the purchase of content through an interface on a client system or via a Web site. The purchase is for a license to the content, not for the content itself. A list of available content is displayed to the user through the client system or the Web site. The invention's central servers log the purchase of the content into a license database. The electronic copy of the song may be already resident on the client system in a hidden area, carouseled in a protected broadcast channel, in the central database ready to be sent out in slices, or resident on a secure server on the Internet. The user accesses content through the client system's user interface where the user plays the content and controls its playback. The invention's service provides an exchange capability similar to stock trading whereby owners offer licenses to various electronic for sale. A seller places his license for a particular content up for sale on the central server where a buyer that is interested in the license places a bid. When a price is agreed to, the invention's central server transfers license ownership in the license database to the new owner.

Owner:TIVO SOLUTIONS INC

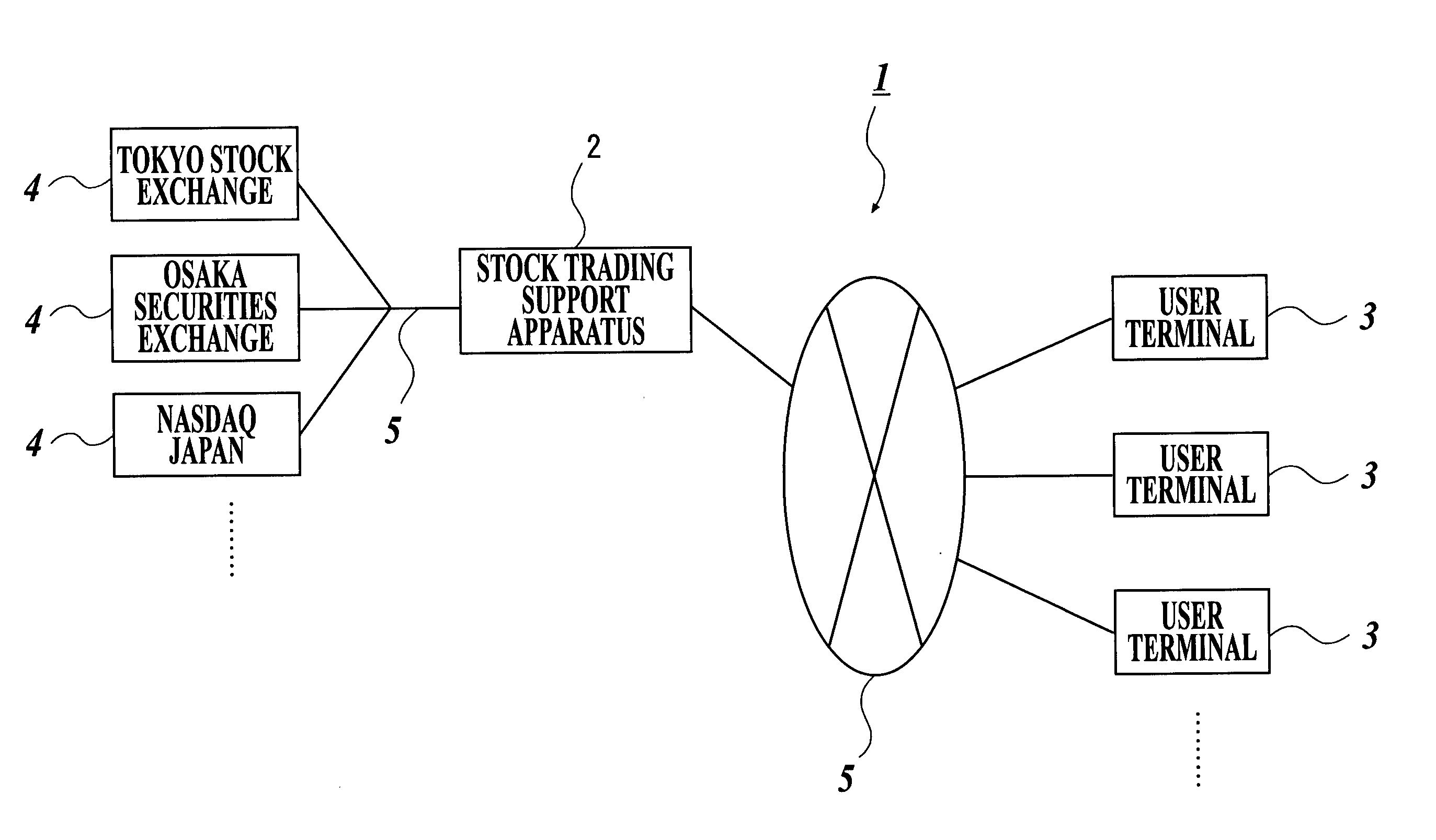

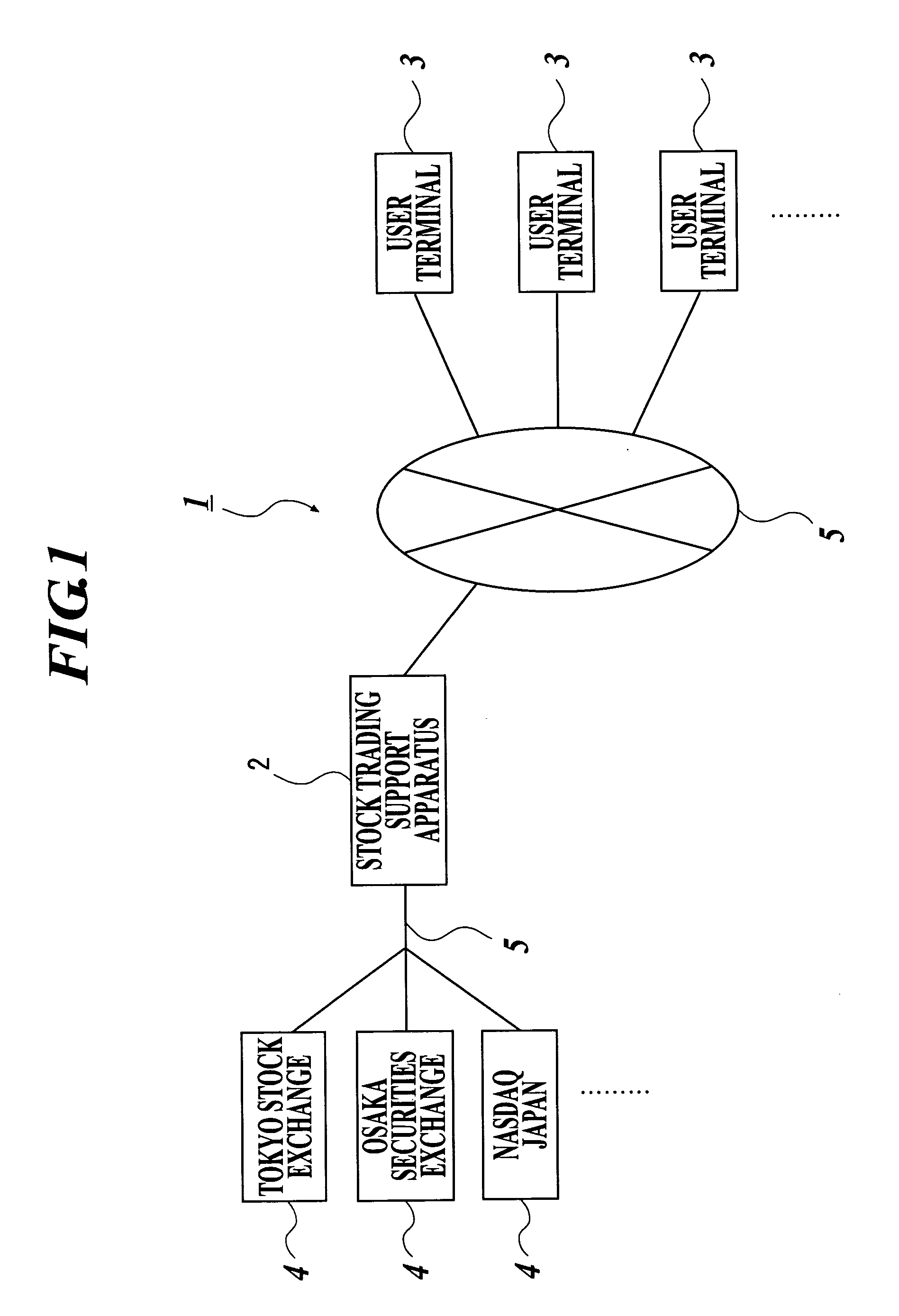

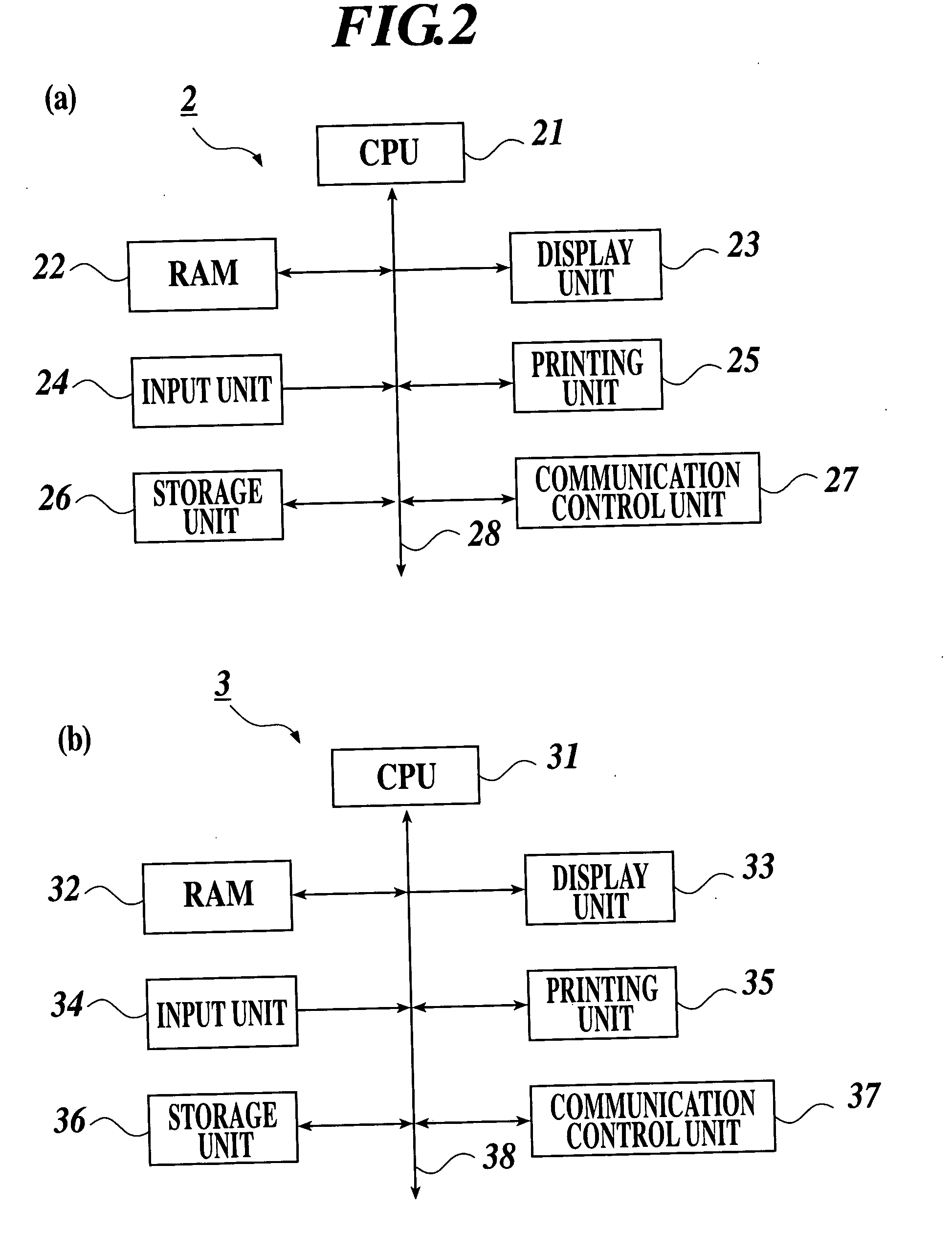

Stock-jobbing support device and stock-jobbing support system

InactiveUS20050262004A1Easily and quickly through the communication networkFinancePayment architectureSupporting systemInformation analysis

A stock trading support apparatus 2 to support stock trading includes: a stock price analysis information creating section (for example, a CPU 21 and the like) to create stock price analysis information by analyzing a stock price of each brand based on stock price information; a promising brand information creating section (for example, the CPU 21 and the like) to create promising brand information by judging whether the each brand is in a good time to buy or sell based on the stock price analysis information created by the stock price analysis information creating section; and an output section (for example, a display unit 23, a printing unit 25 and the like) to output stock information containing the stock price analysis information and the promising brand information.

Owner:TAMARU INT

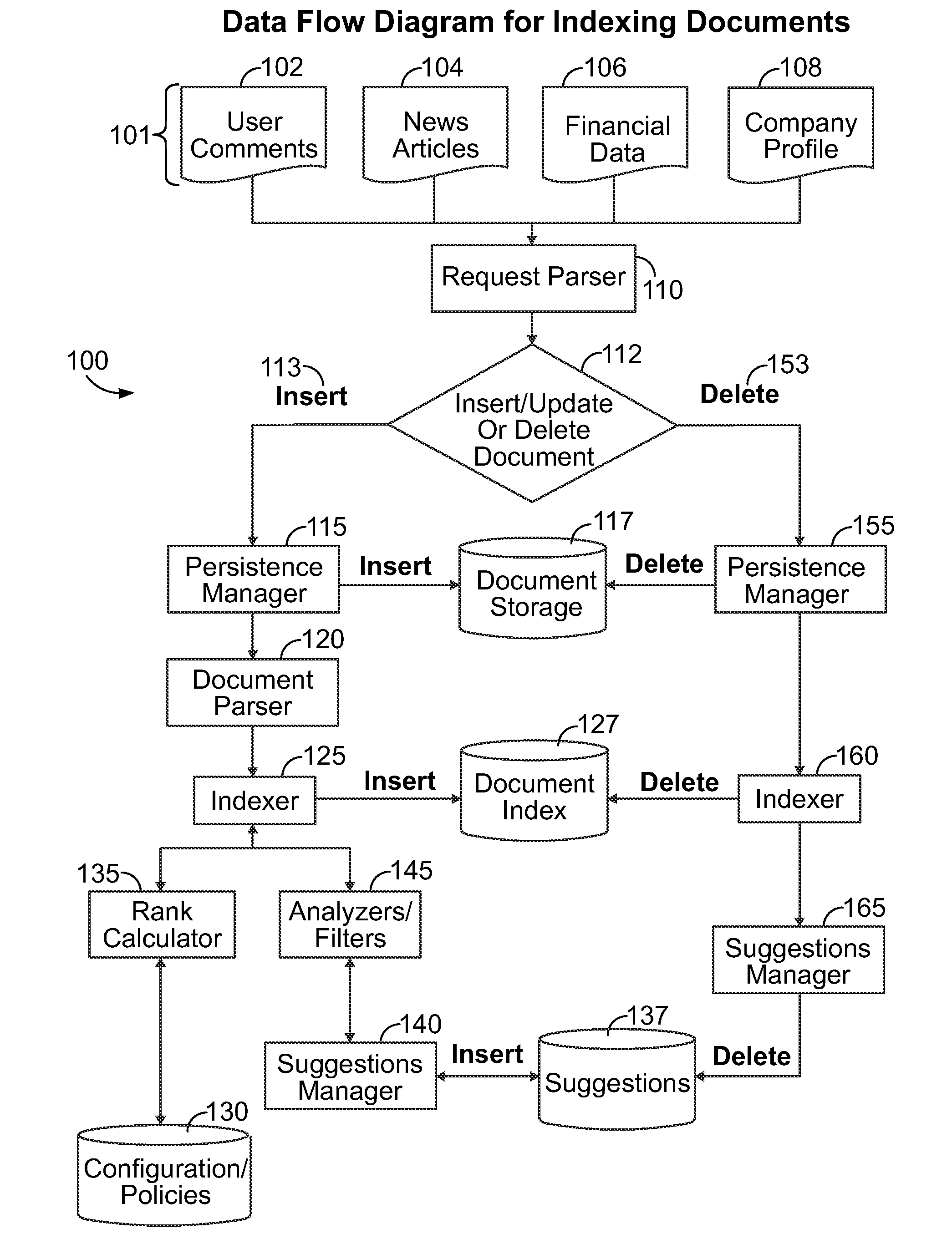

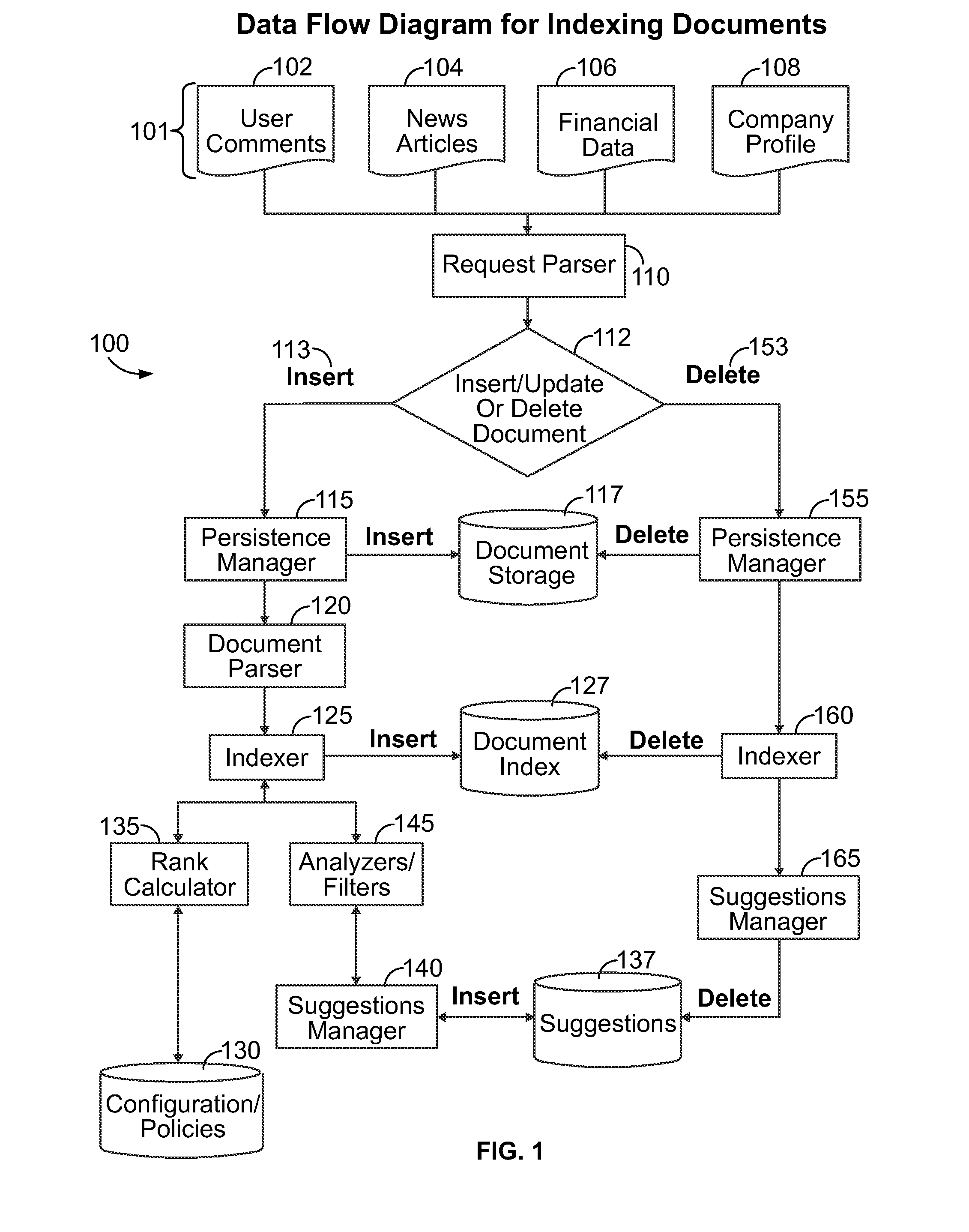

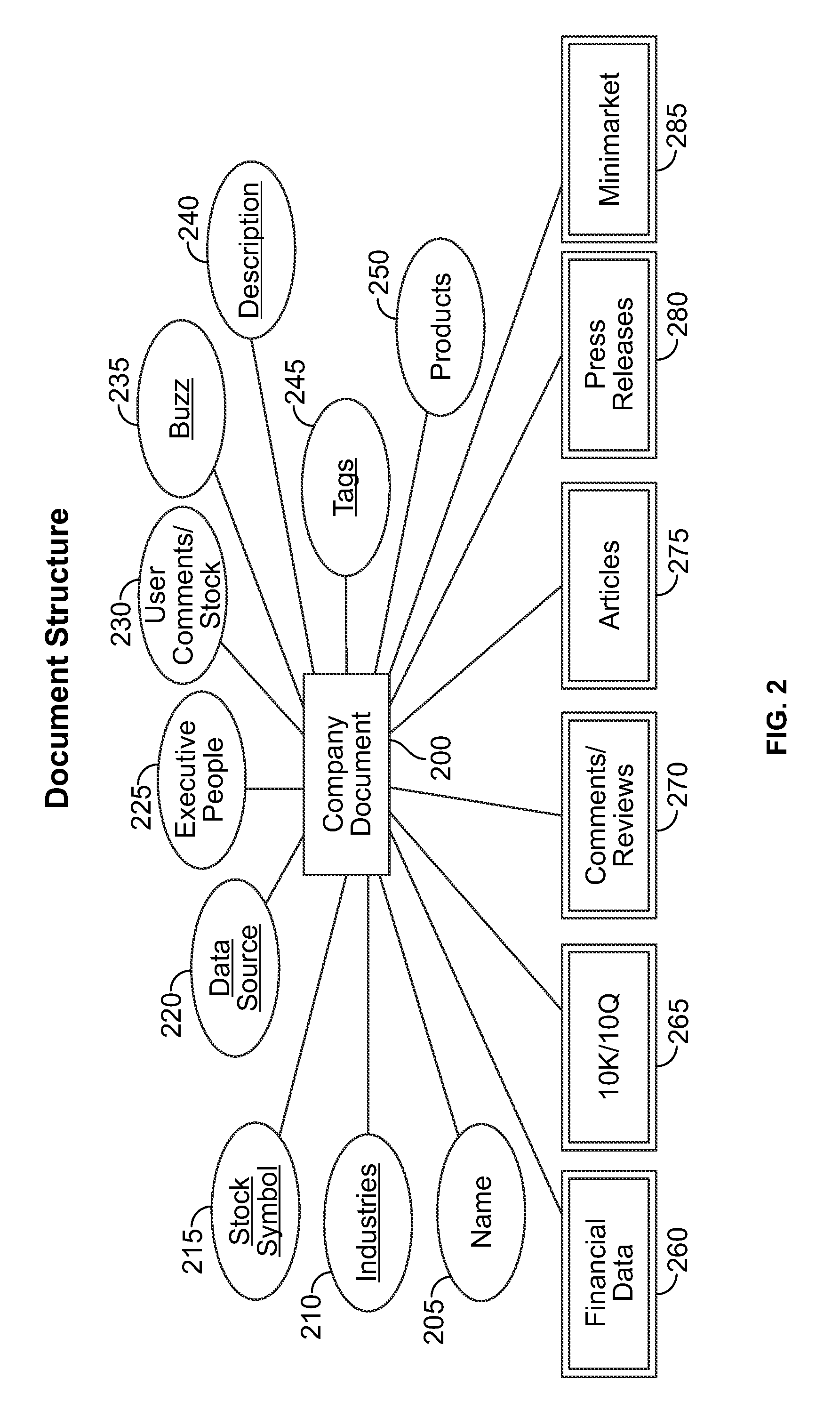

Systems and Methods for Interest-Driven Stock market Segmentation and Stock Trading

Systems and methods for indexing and searching companies for use in a stock trading application are provided. Indexing may assign a scoring system based on the several pre-determined factors as well as the data source from which the data has been received. Additionally, the indexing methodology supports the creation of minimarkets of stocks based on a term-based or user interest-based groupings of companies.

Owner:BHATTI SHAHZAD +4

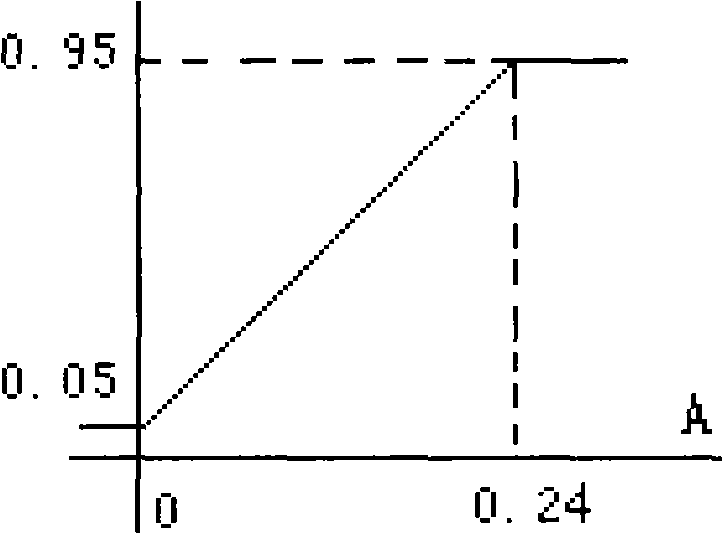

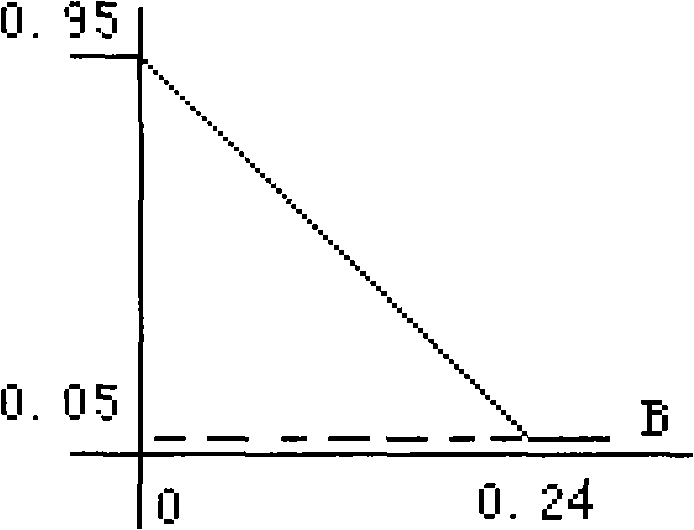

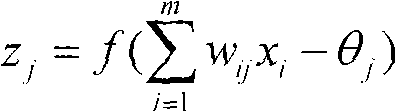

Method for model building, forecasting and decision-making of stock market based on BP neural net

InactiveCN101276454AEfficient methodEasy to operateFinancePhysical realisationBusiness forecastingMarket based

Owner:ZHONGYUAN ENGINEERING COLLEGE

Electronic Trading System Supporting Anonymous Negotiation and Indicators of Interest

A system conducts anonymous negotiations and supports indications-of-interest in trading stock. The system includes a database for storing public orders received from a public stock trading system; and a server for receiving hidden orders from a plurality of users and for conducting anonymous negotiations between first and second users with the hidden orders. The server repeatedly accesses the database to determine a match of any one of the hidden orders with any one of the public orders, and to execute a pair of orders selected from the hidden orders and the public orders. The system also transmits indicators-of-interest (IOIs) into a trading environment using the server for processing a trading order from a first user and for maintaining a profile of a user. The profile includes a current IOI setting for controlling transmission of the IOI from the user. The server responds to a toggle command from the first user to control transmission of the IOI opposite to the current IOI setting. The server responds to the IOI setting being set to allow transmission by transmitting the IOI of the first user associated with the trading order.

Owner:BLOOMBERG

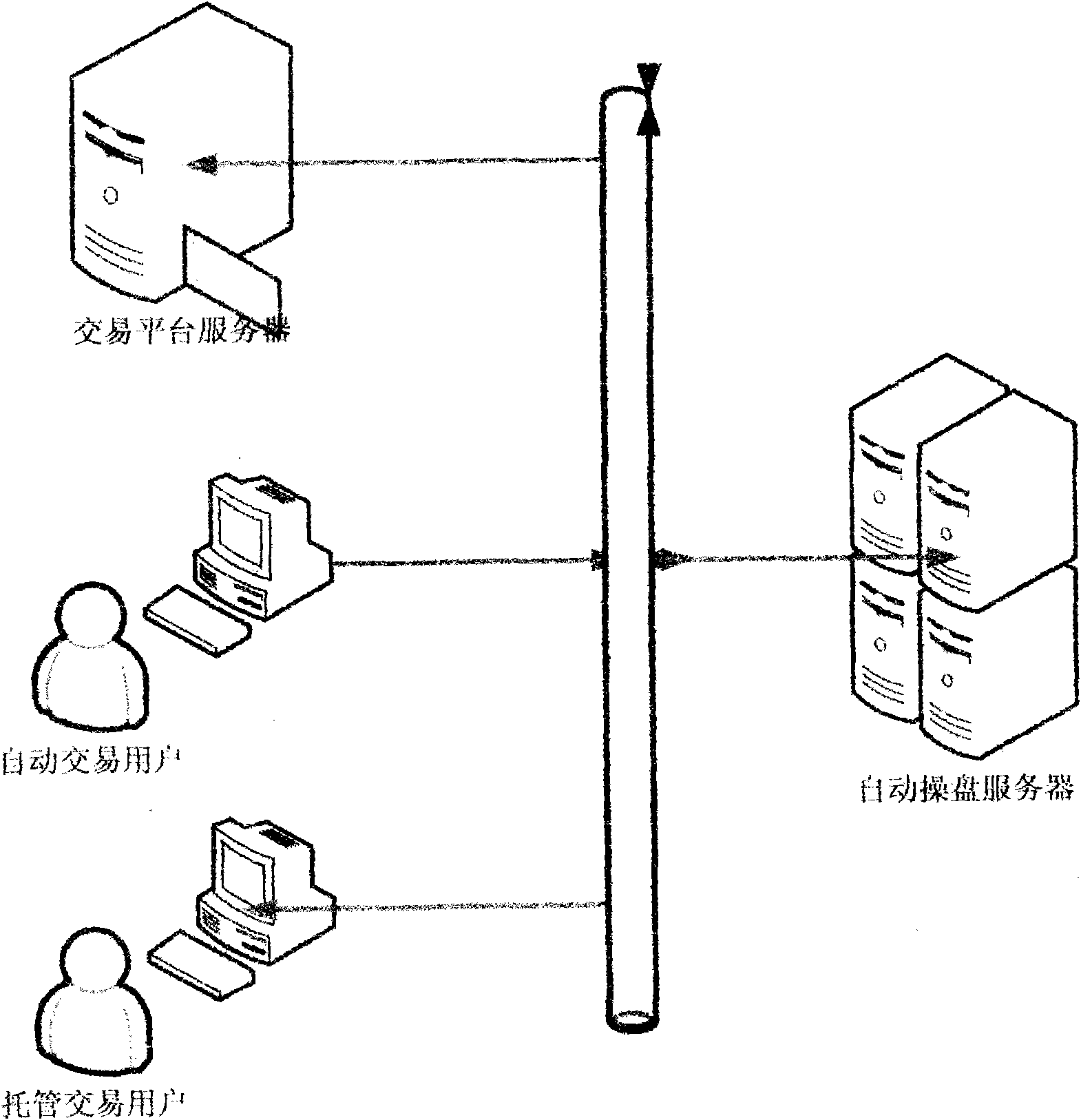

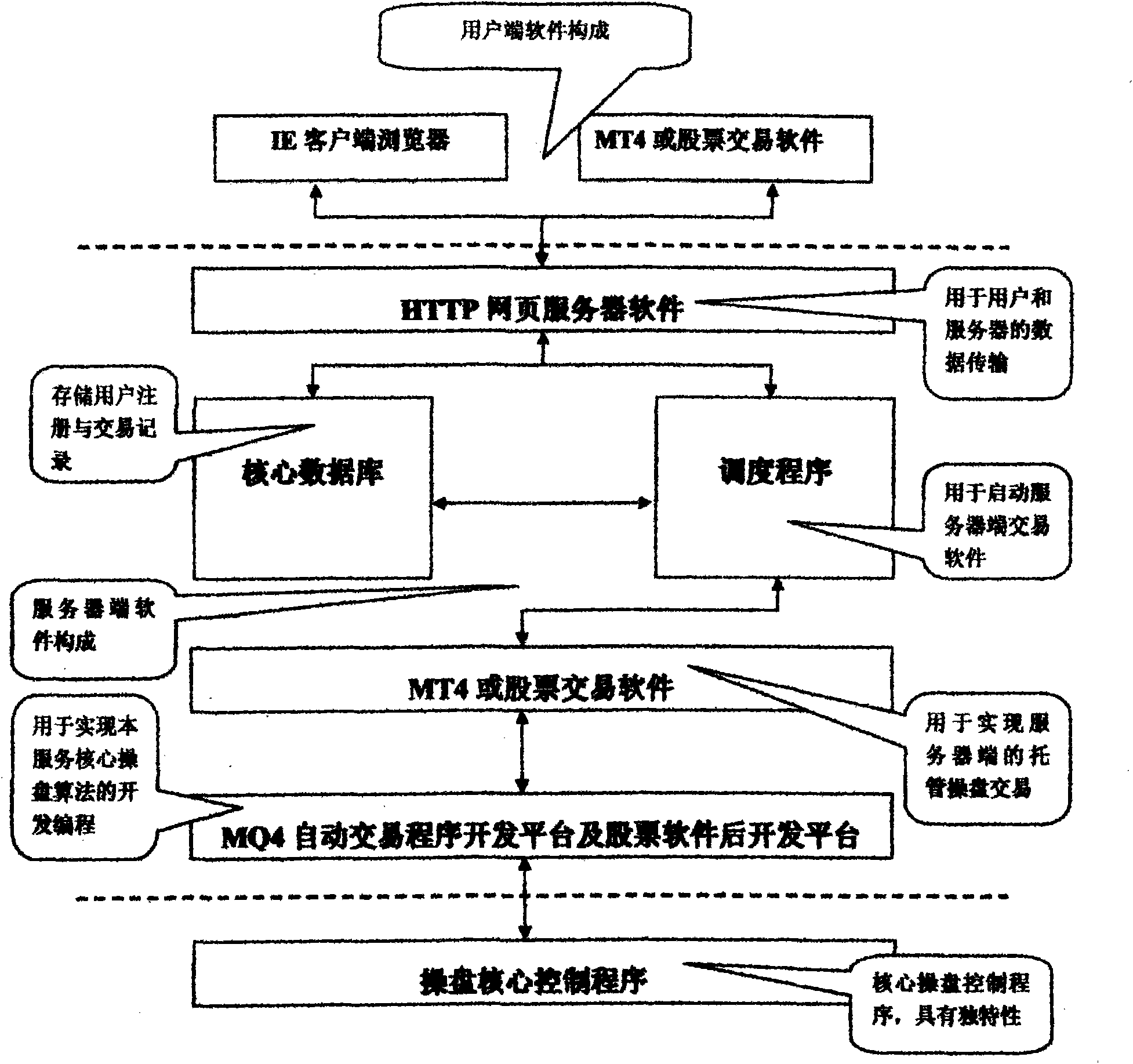

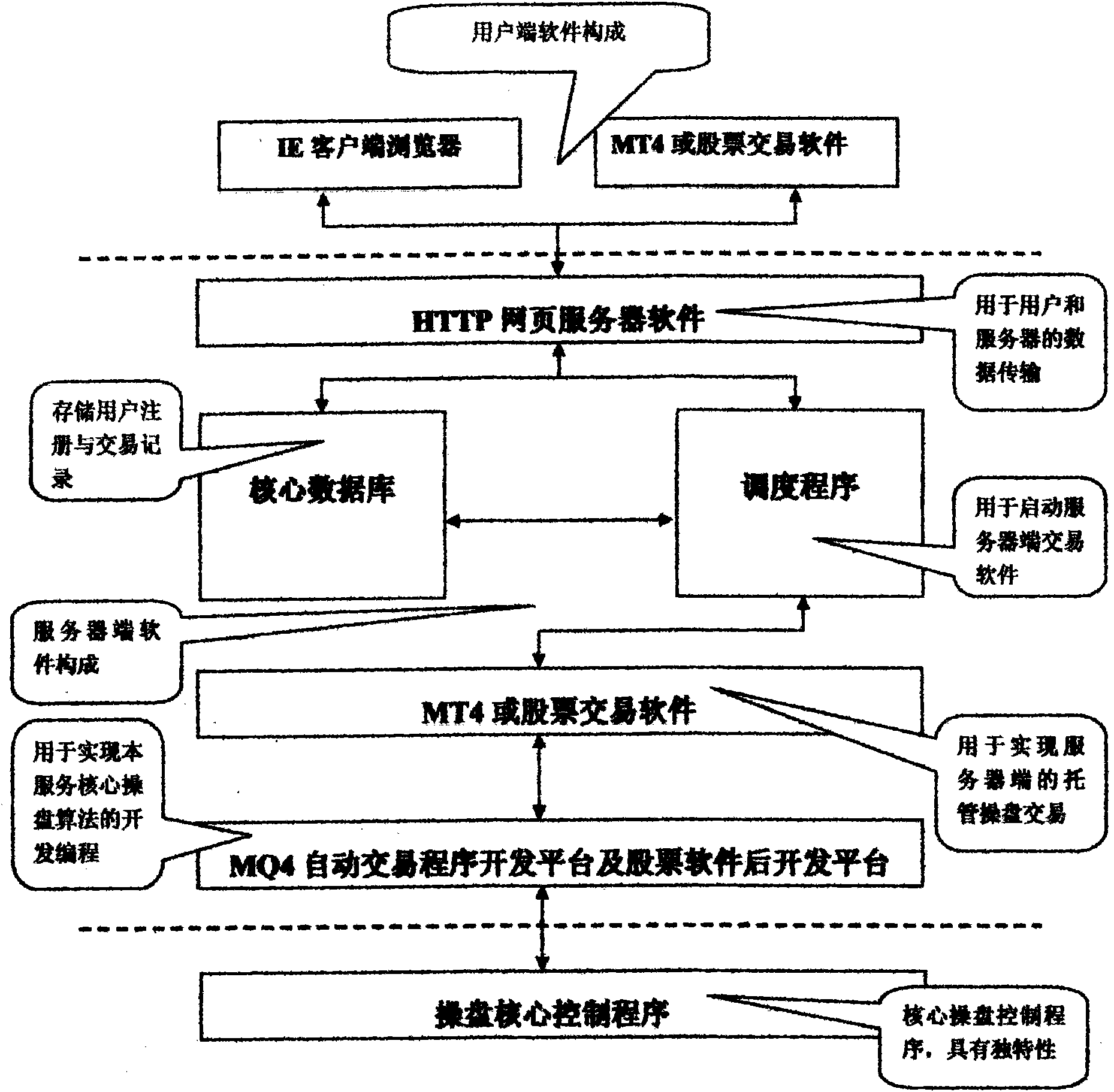

Fully-automatic stock operation server

The invention relates to a fully-automatic stock operation server, belongs to the field of computer server, and aims to realize automated stock operation with a high success rate and stable profit. The fully-automatic stock operation server consists of an IE client browser, an MT4 or stock trading software, HTTP web server software, a core database, a scheduling program, an MQ4 intelligent trading program developing platform, a stock software background developing platform, and a stock operation core control program. The fully-automatic stock operation server has the advantages of automatic stock operation, capability of overcoming subjective and emotional errors of artificial market analysis and stock operation, high success ratio, high stability and high profit; the core stock operation algorithm of the system is tested by long-term historical data and real-time data, which proves that stock operation profit success ratio is over 90 percent, the profit curve straightly rises, the annual investment return is over 50 percent, and the fully-automatic stock operation server is suitable to be used by people engaged in investment and market analysis of financial security.

Owner:帅亿

Data-driven self-training system and technique

InactiveUS20010034730A1Improve performanceDigital data processing detailsElectrical appliancesPersonalizationSystems analysis

An automated training system and method for providing personalized instruction or advice to a plurality of users or students in a simple, easy-to-use manner to improve their performance in their respective domain, i.e., specific filed of human activity such as sports, stock trading, gardening, etc. The system analyzes the user's performance data to determine domain-specific performance metrics and generates advice / instruction based on the performance metrics.

Owner:VIRTUAL GOLD

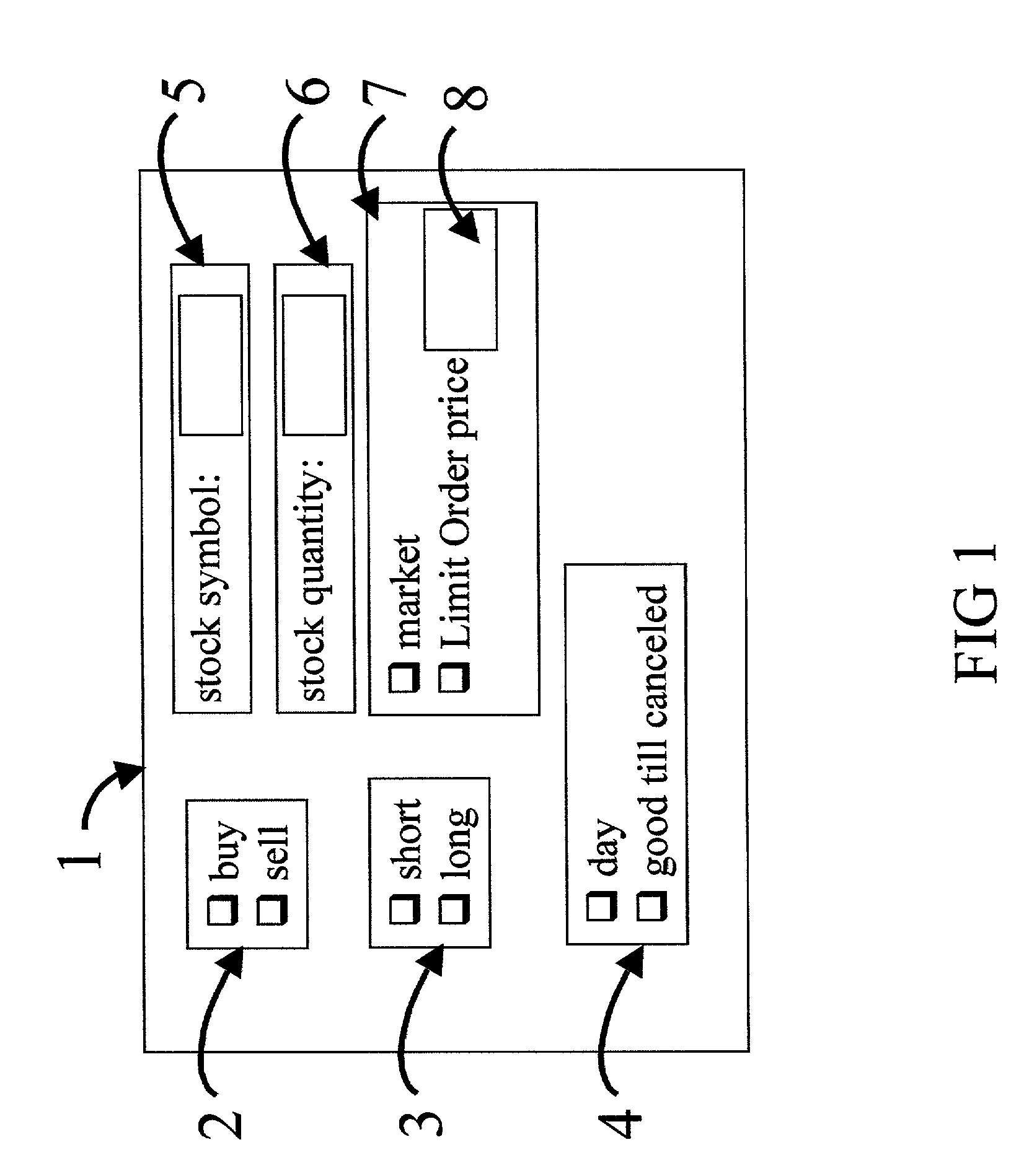

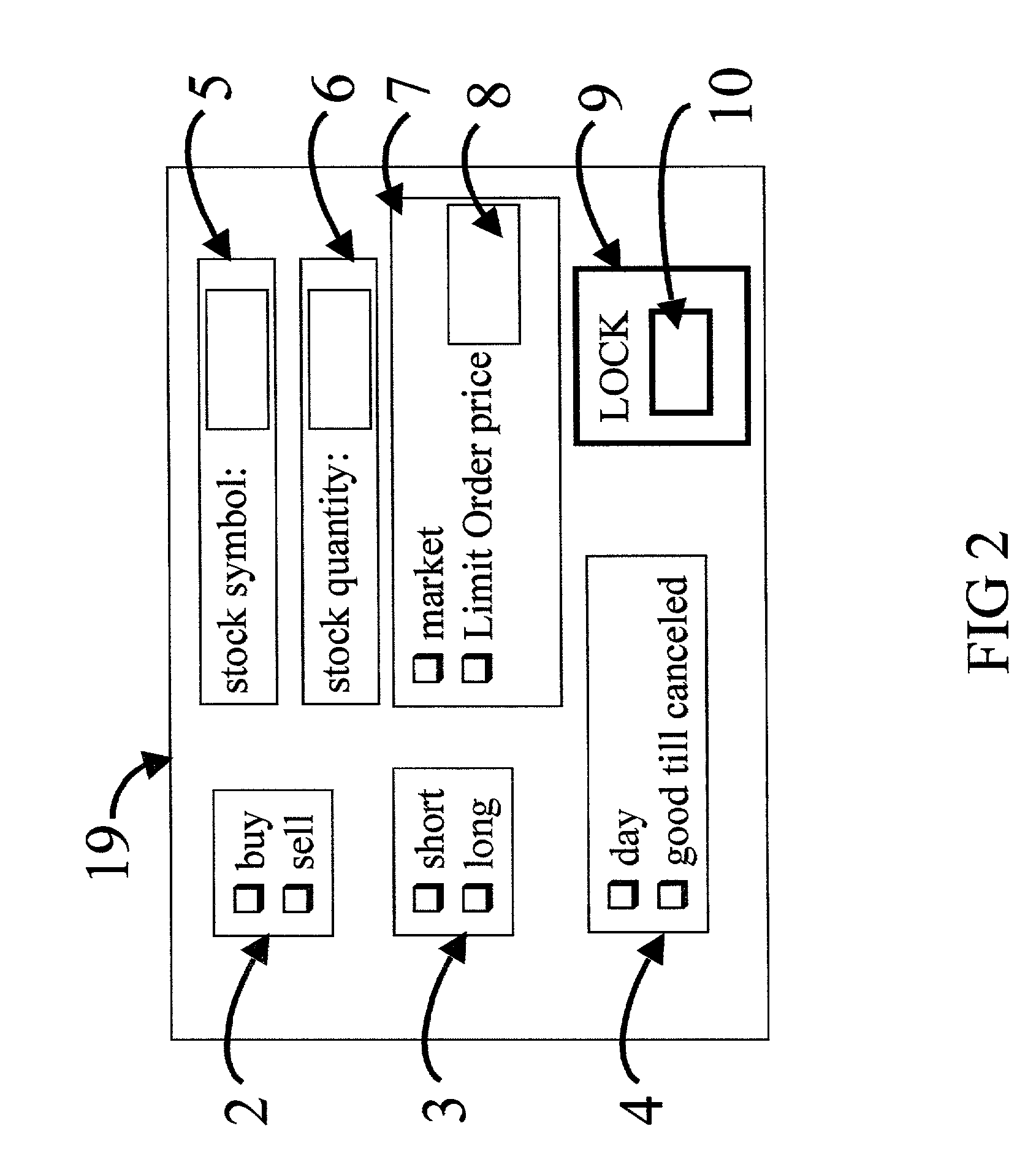

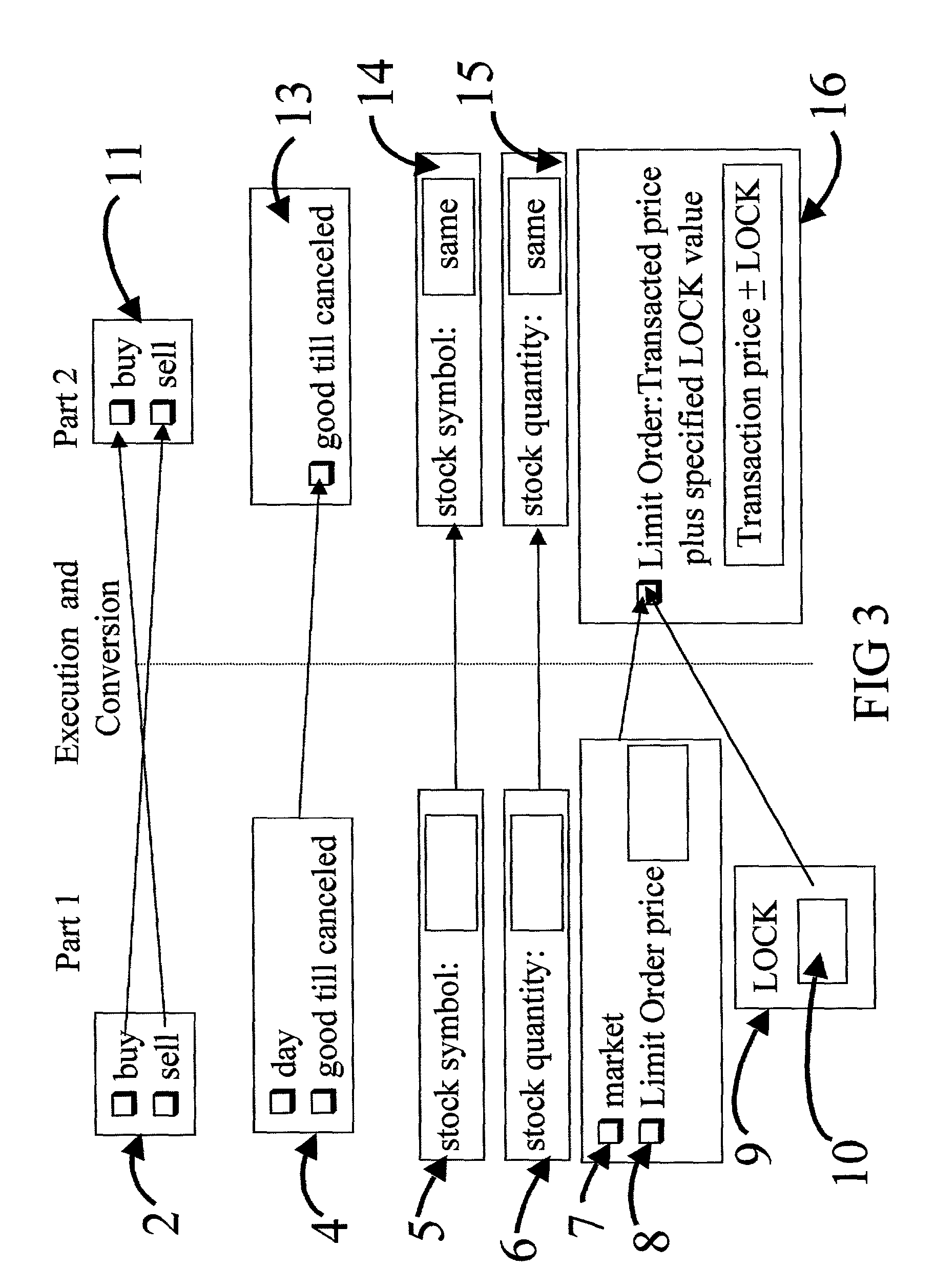

Stock trading limit order coupled link (Lock)

ActiveUS7386499B2Easy to implementBig advantageFinancePayment architectureEngineeringPrice fluctuation

This invention has the potential to generate very good return on investments from stocks that are conservative in movement. This invention will greatly benefit investors that do not have the time to constantly trade stock yet want to take advantage of normal price fluctuations. The Limit Order Coupled LinK (LOCK) invention, for example, will take a buy order, complete the transaction at the specified price, then automatically resubmits a new order to sell at a specified higher price. If specified, the process can automatically cycle through the buy-sell process a set number of time allowing the investor to take advantage of intra-day market moves and normal stock price fluctuations with no personal investor evolvement. The LOCK order, with set profit margins, allows on-line traders and brokers to place one order, which will automatically generate logical, sequenced additional orders returning a profit on each transaction. LOCK will benefit both the investor and the stock trading company.

Owner:KOCHER ROBERT

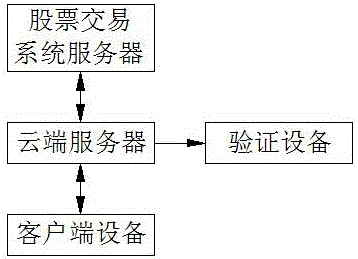

Stock trading management system

InactiveCN106355498AEarnings increaseImprove transaction operation abilityFinanceManagement systemStock trading

The invention relates to a management system, in particular to a stock trading management system, which is characterized in that a user firstly carries out simulated stock trading on a virtual trading platform according to actual stock information; when a certain surplus demand of the user is met during a virtual stock trading process, the system is automatically transferred into an actual stock trading activity; once a certain loss (such as a loss trading rule is reached) occurred during virtual stock trading or actual stock trading, an account is immediately saved and closed, and the account can be re-activated for stock trading only if the user carries out related operation in the follow-up stage. Therefore, the stock trading operation capacity of the user is improved, meanwhile, the capital of the user can also be risk-controlled, and the probability of capital surplus of the user is further improved.

Owner:上海红宋网络科技有限公司

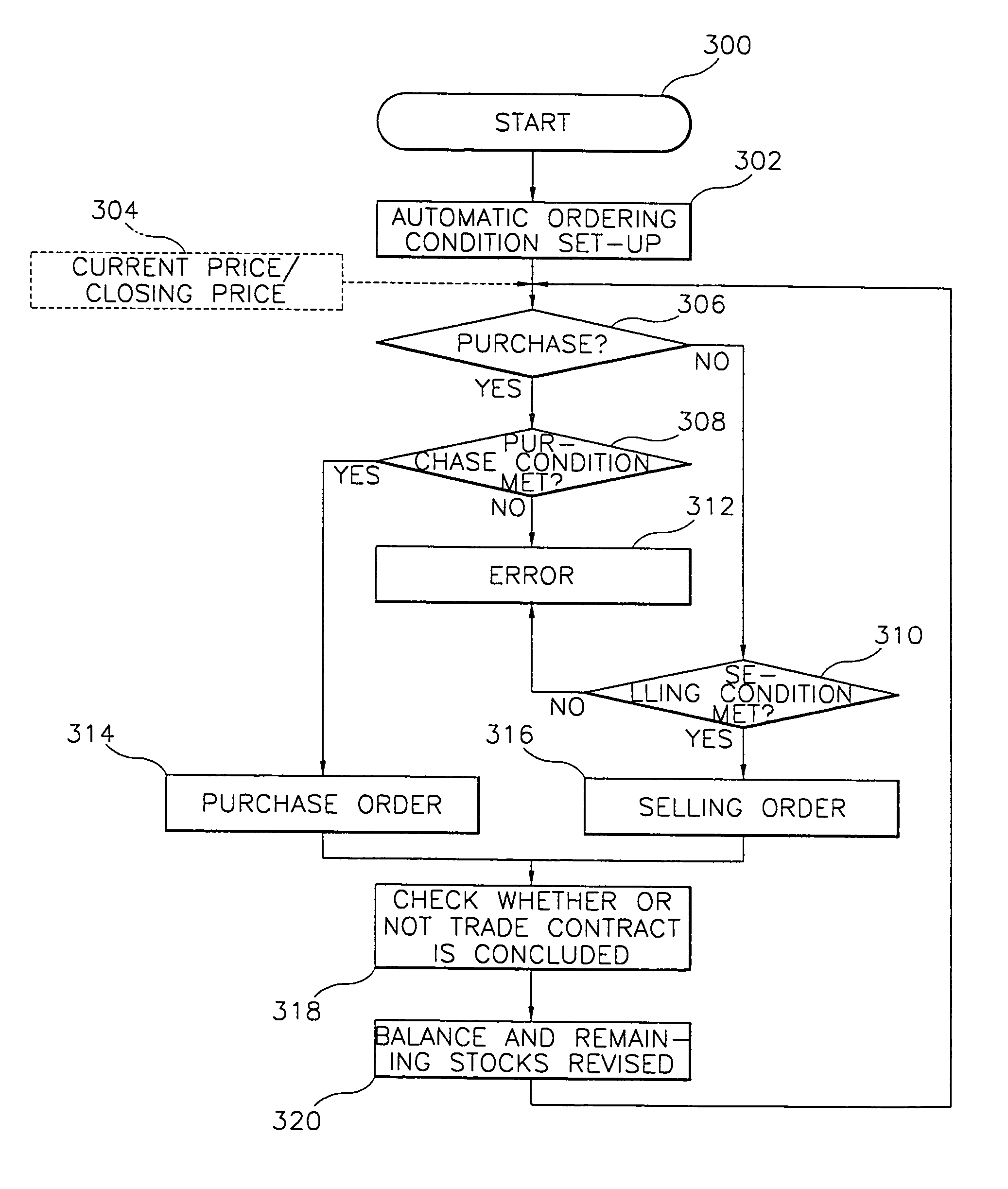

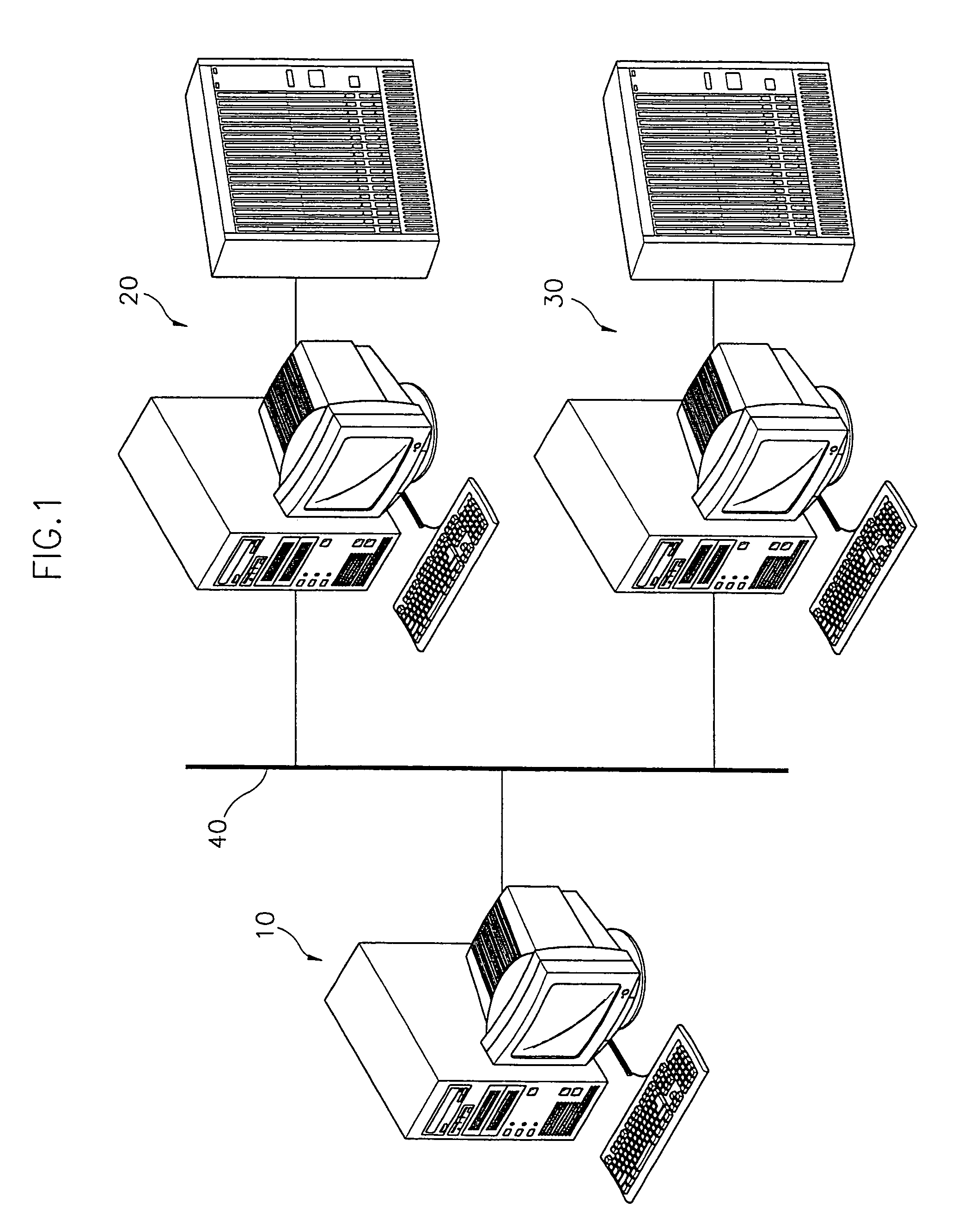

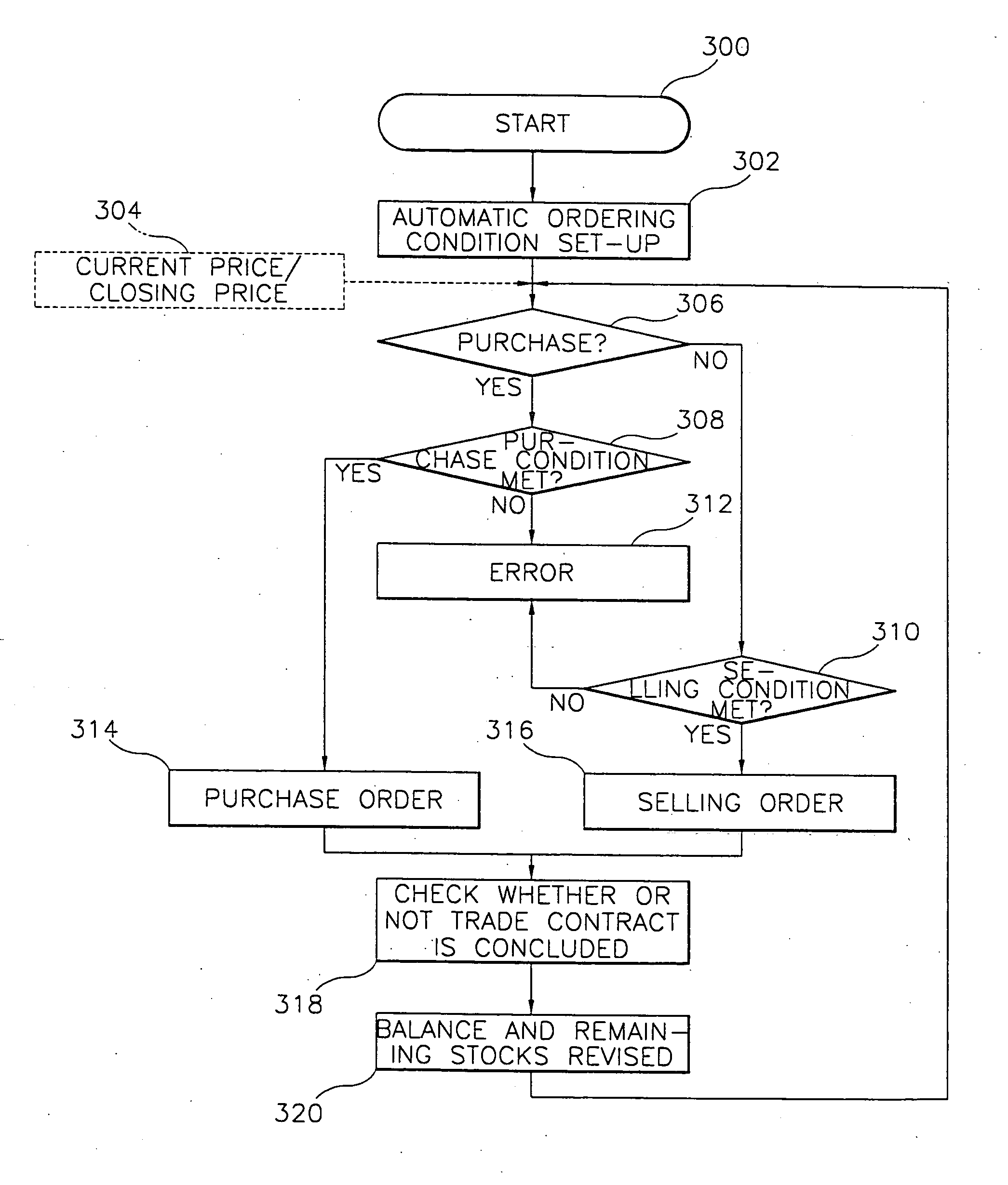

Computer software and system for automatic stock dealings

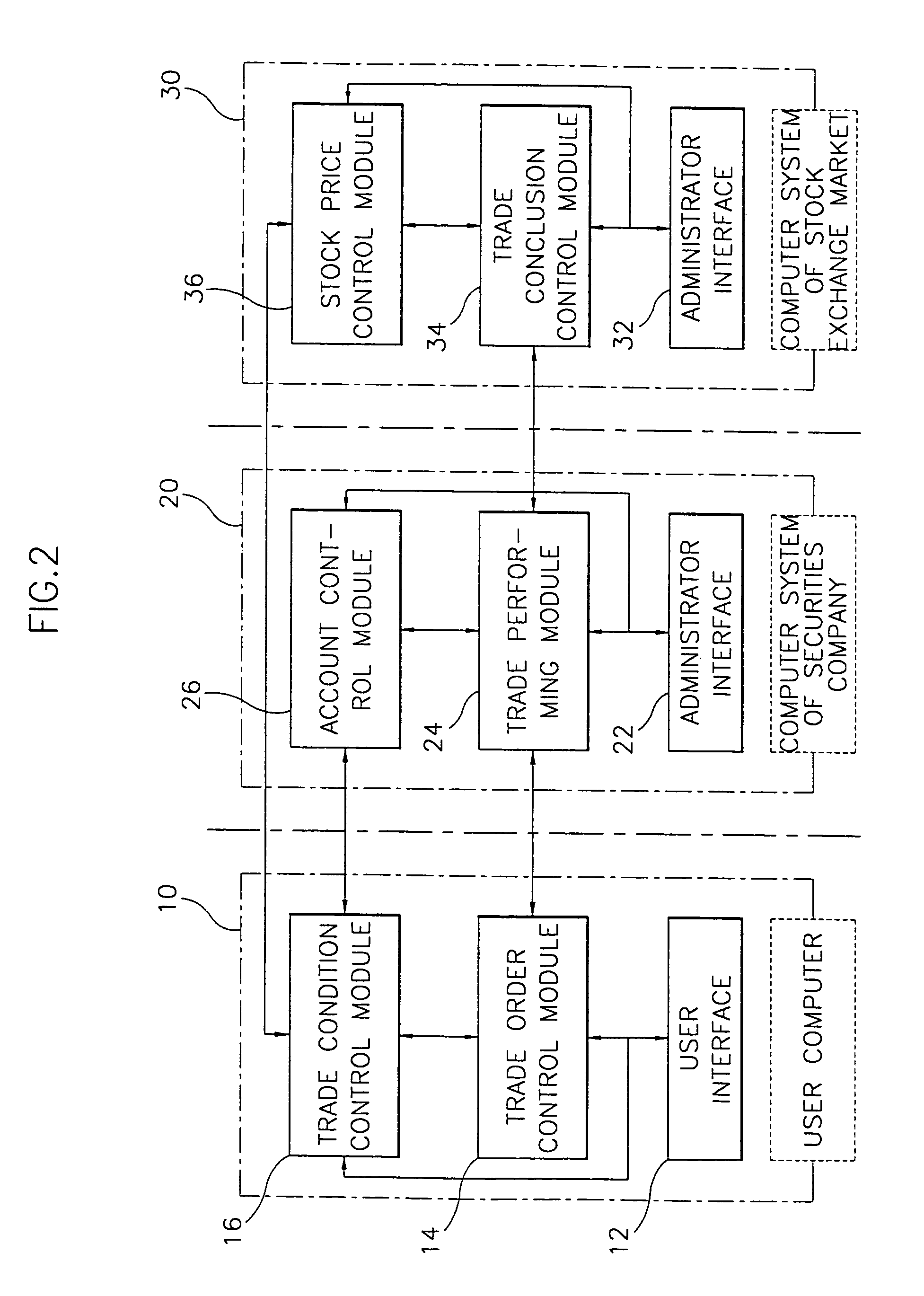

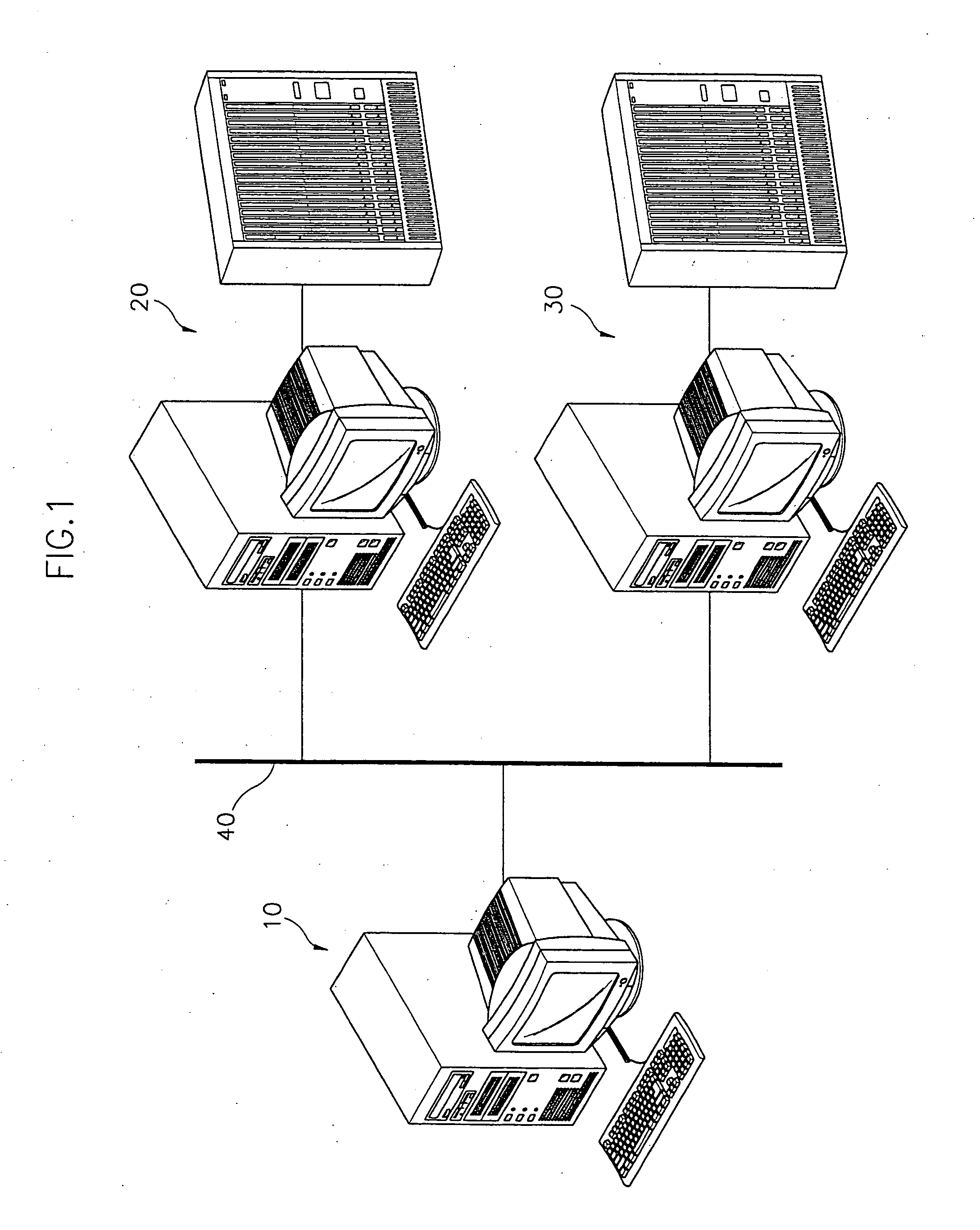

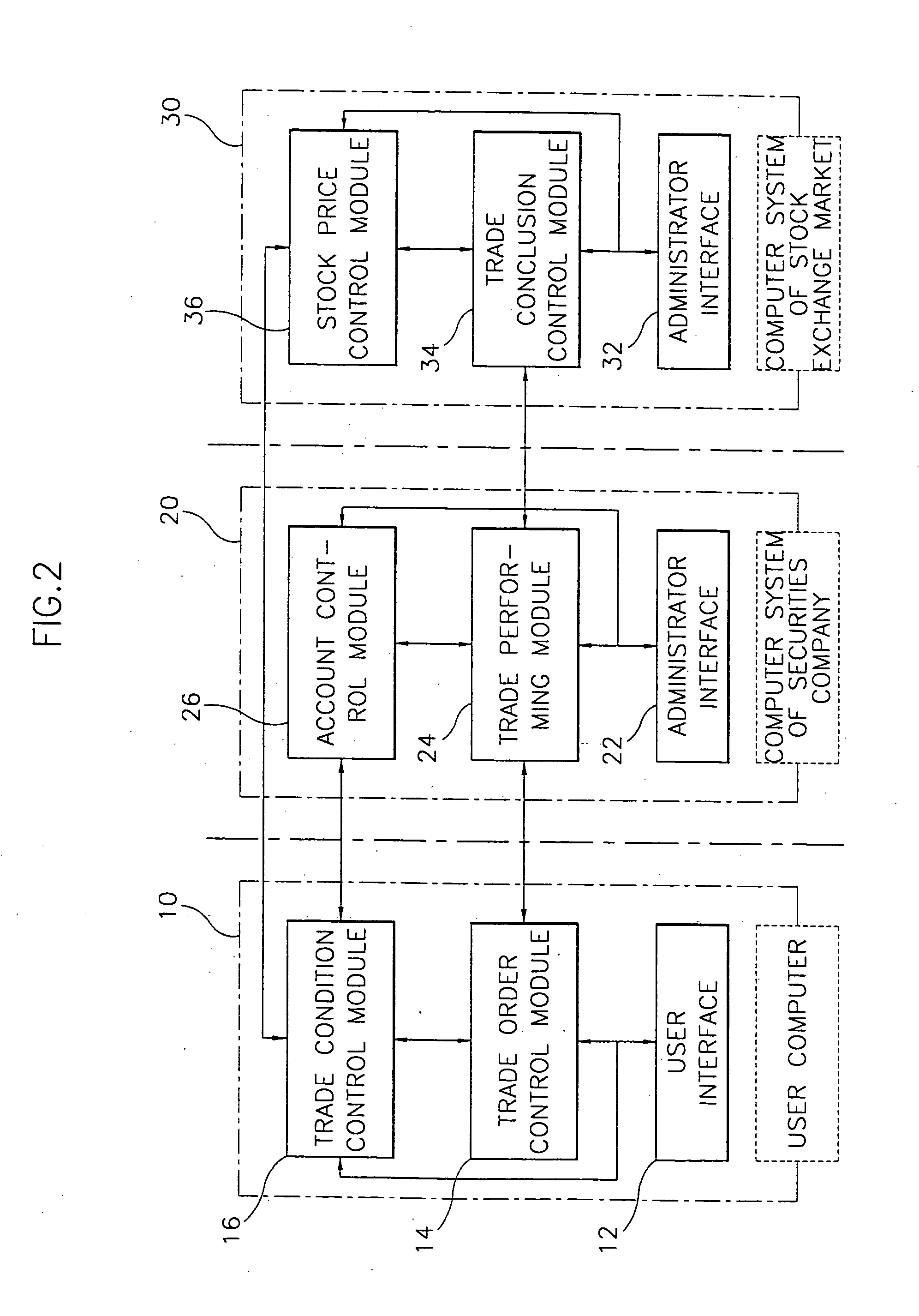

A computer readable medium is configured with instructions for causing a first computer system connected to a computer system of stock exchange market via a data communication network to automatically place a series of stock trade orders. The first computer system can include, for instance, a user computer, a brokerage computer, or both. An automated system for systematically and repeatedly placing stock trade orders based on predetermined conditions is also provided. In general, the automated system or computer system running the software operates by receiving and storing an automatic stock trading condition. A stock trading order can be placed immediately following a previously contracted order, or when a stock market status satisfies the preset stock trading condition. The first computer system preferably receives user input including basic information such as an item code of the stock and an account number of a stockholder. Automatic trade condition information can also be input into the first computer system by the user or a broker and preferably provides information for determining a desired selling price and quantity and / or a desired purchasing price and quantity for trading of the stock. Market data, preferably including the stock price is received into the first computer system via the data communication network, such as from the stock exchange market computer system. The first computer system can then determine whether a stock purchase or sale condition generated using the automatic trade condition information has been met and place a stock purchase or sale order via the data communication network when the stock purchase or sale condition is met. This system can systematically repeat the process using the automatic trade condition information as a guide for trading. The process can be repeated continuously or can be stopped when a predetermined condition is satisfied.

Owner:CHA MIN HO

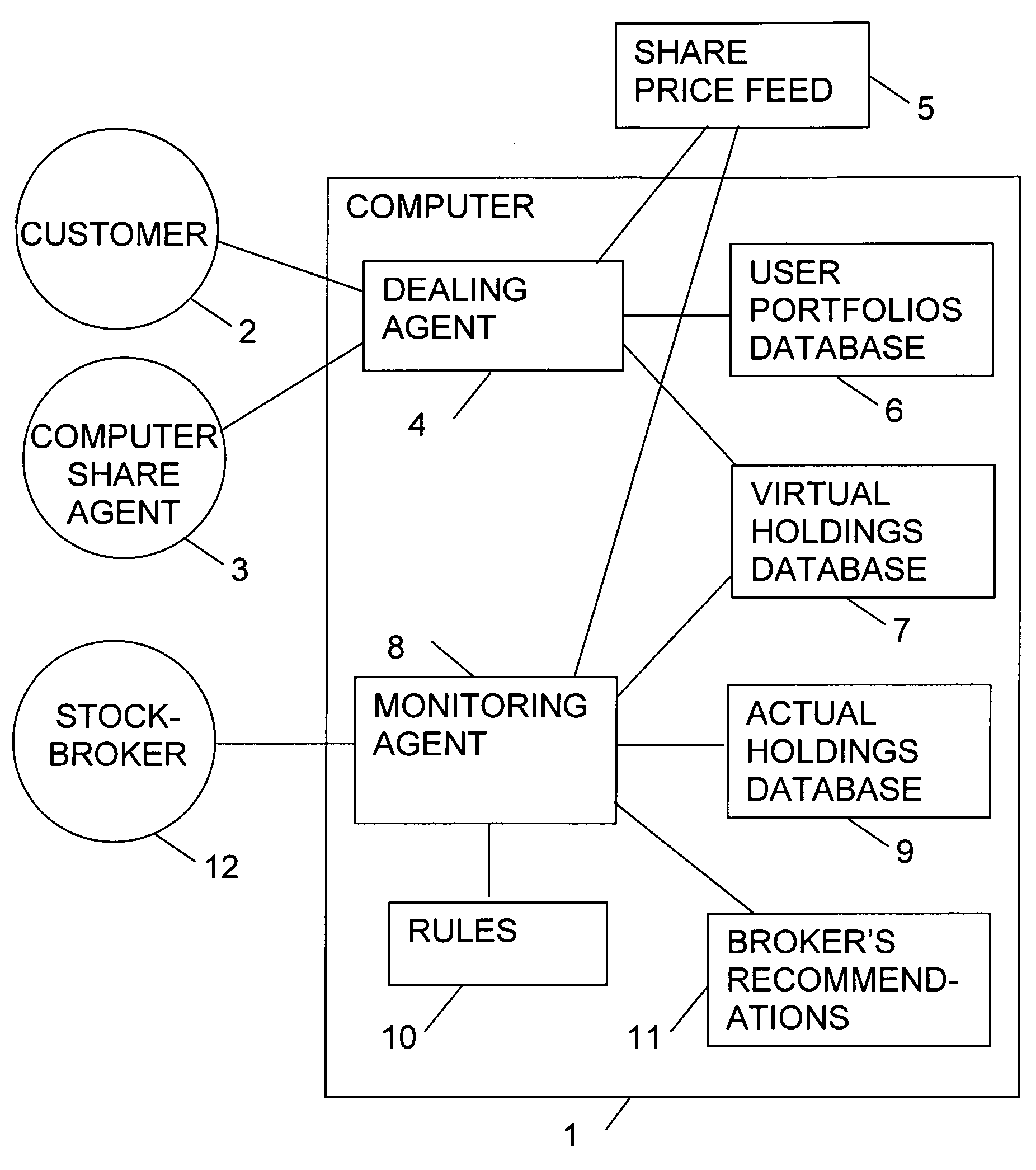

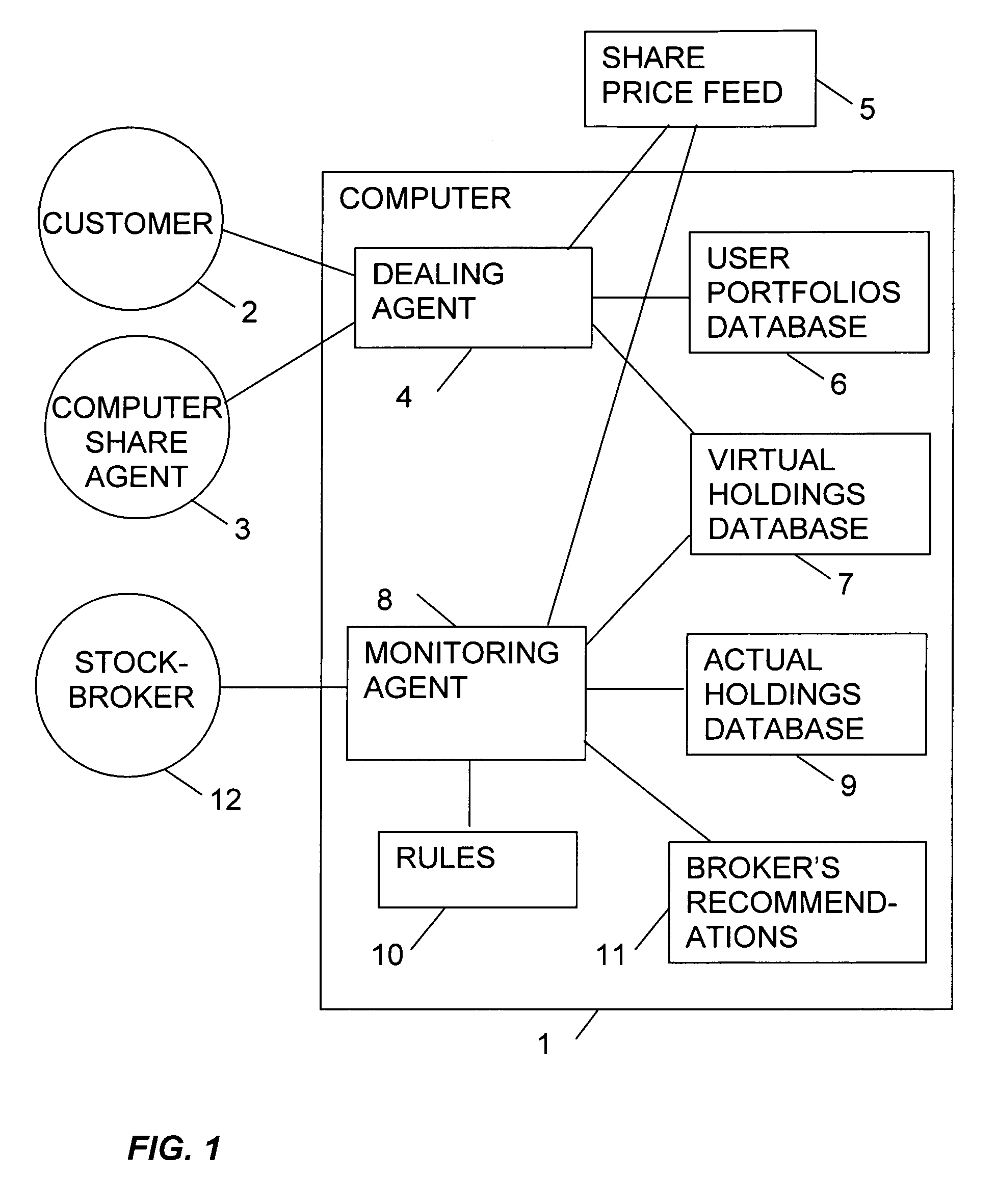

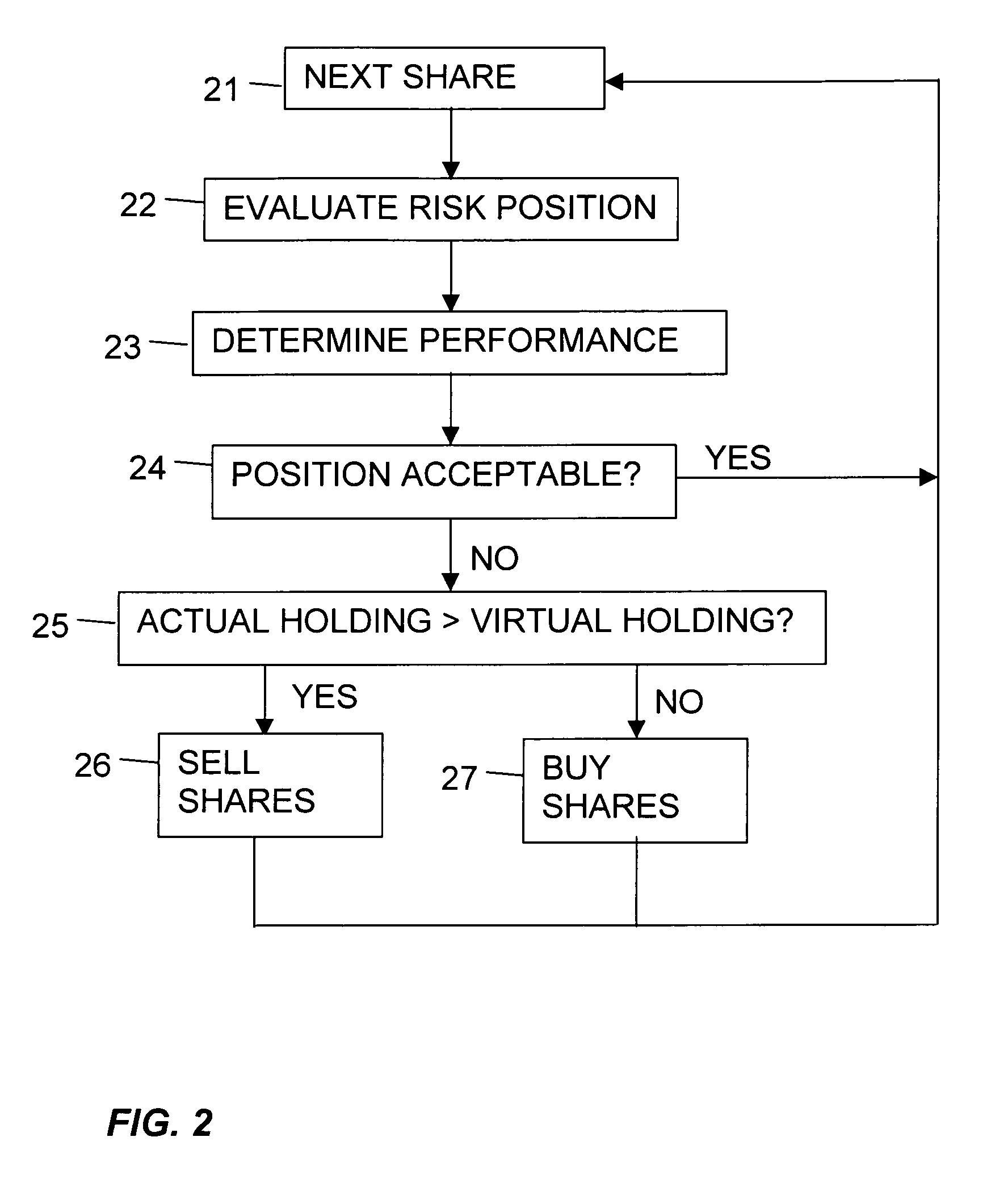

Computer system for virtual share dealing

A computer system buys and sells virtual shares on behalf of investors, usually investing small sums, in order to reduce the dealing costs for small transactions. The system thus maintains a notional level of shares held on behalf of all the investors who participate in the system. A monitoring process runs continually checking exposure on individual shares, and the system buys and sells blocks of real shares in the market to keep the exposure to individual companies at an acceptable level. By buying and selling larger blocks of real shares on a more infrequent basis than the virtual share transactions, the smaller transactions are effectively consolidated together, with associated cost savings.

Owner:FUJITSU SERVICES

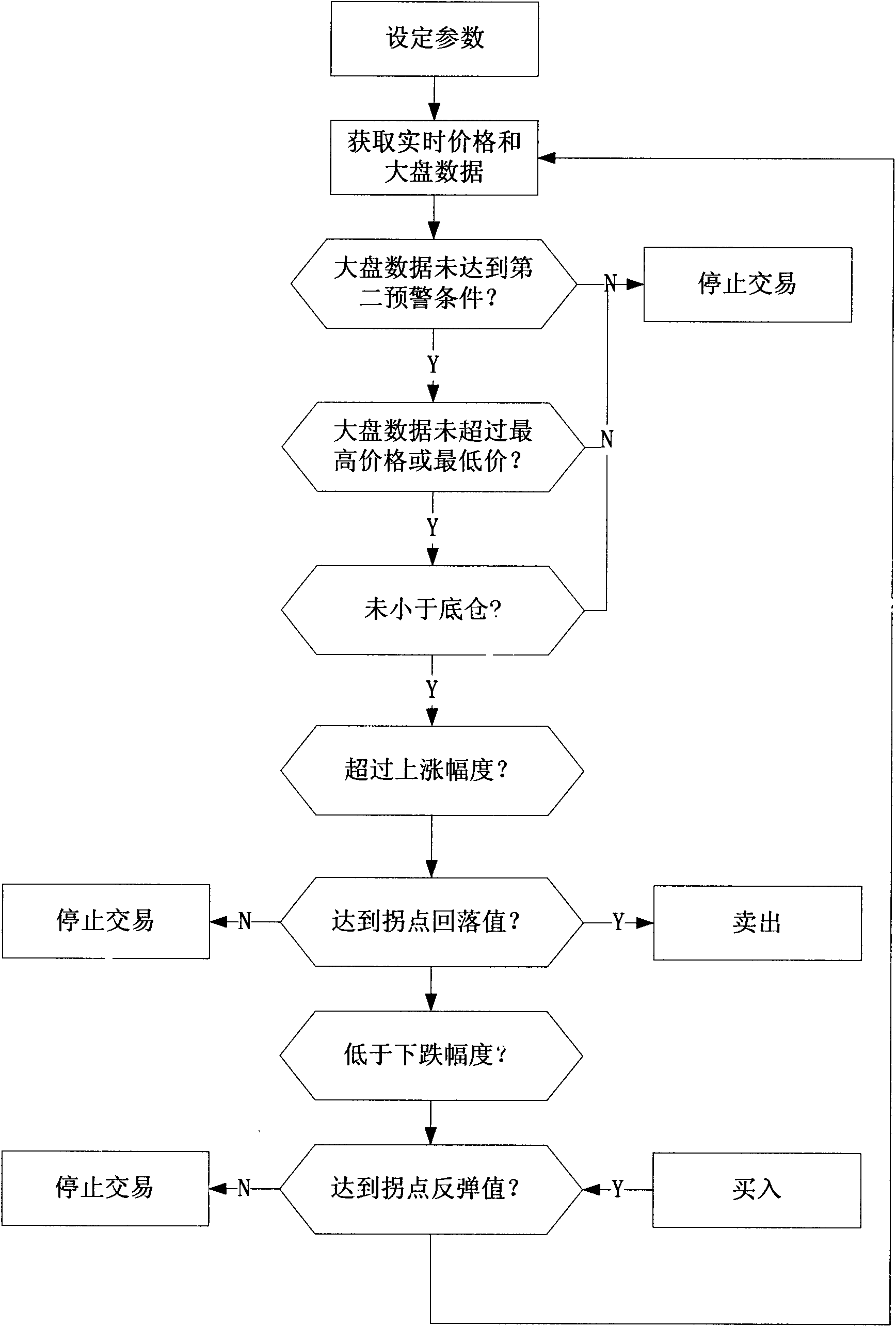

Method for monitoring stock transaction

The invention discloses a method for monitoring stock transaction, which includes the following steps: A, selecting a specified stock, setting the highest price and the lowest price after the stock trading is halted, setting the amount of funds or shares for each trading of the stock and the total buying frequency, and setting the base price, selling rise range and buying dropping range of the stock; B, acquiring the real-time price of the stock through a networking computer, selling the stock as per the amount of funds or the shares of each trading if the difference value of the real-time price and the base price surpasses the rise range, buying the stock as per the amount of funds or the shares of each trading if the difference value of the real-time price and the base price is lower than the drop range, and prompting in halting the transaction if the real-time price surpasses the highest price or is lower than the lowest price. The method can improve the earnings and lowers the transaction exposure.

Owner:王林

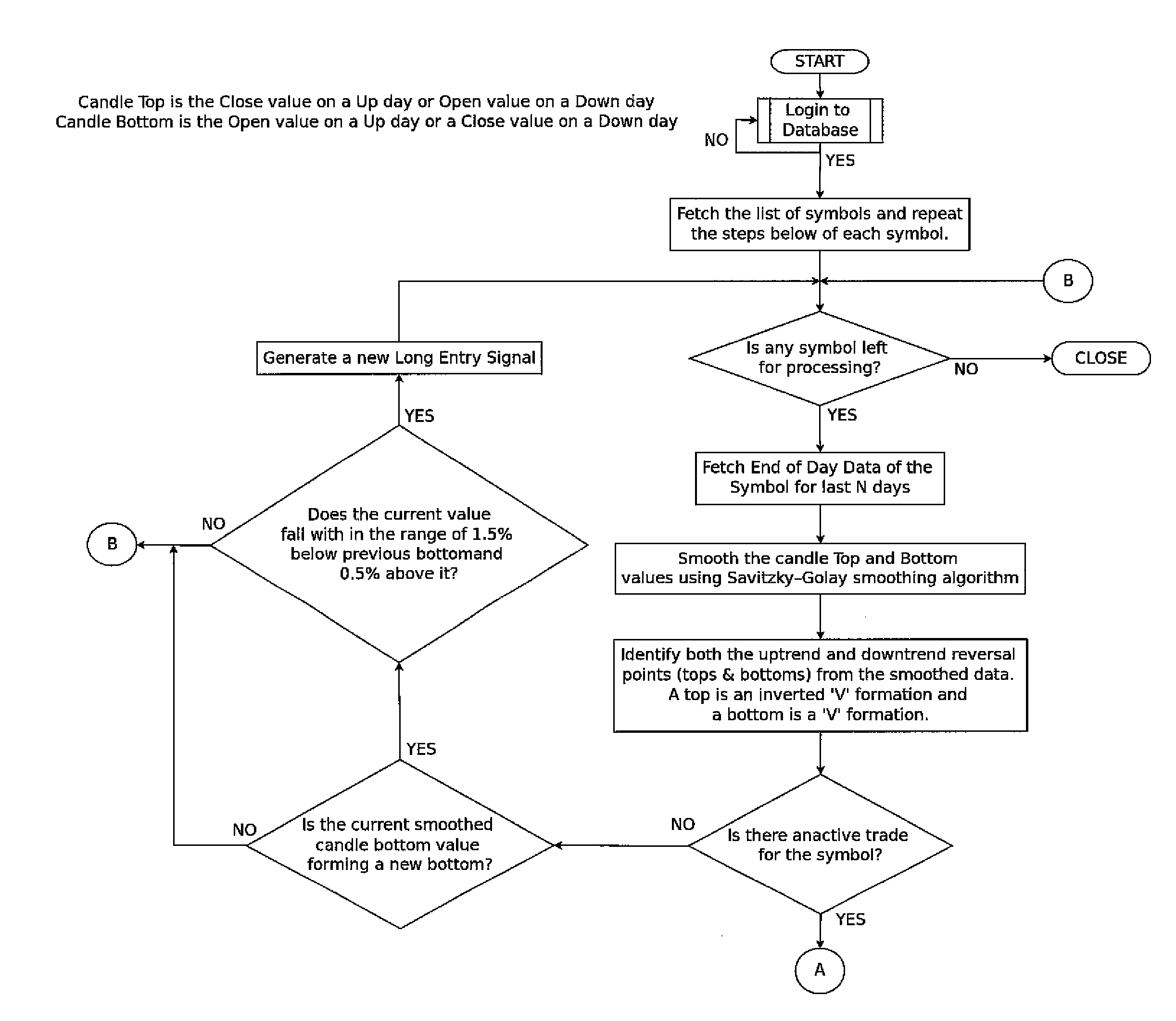

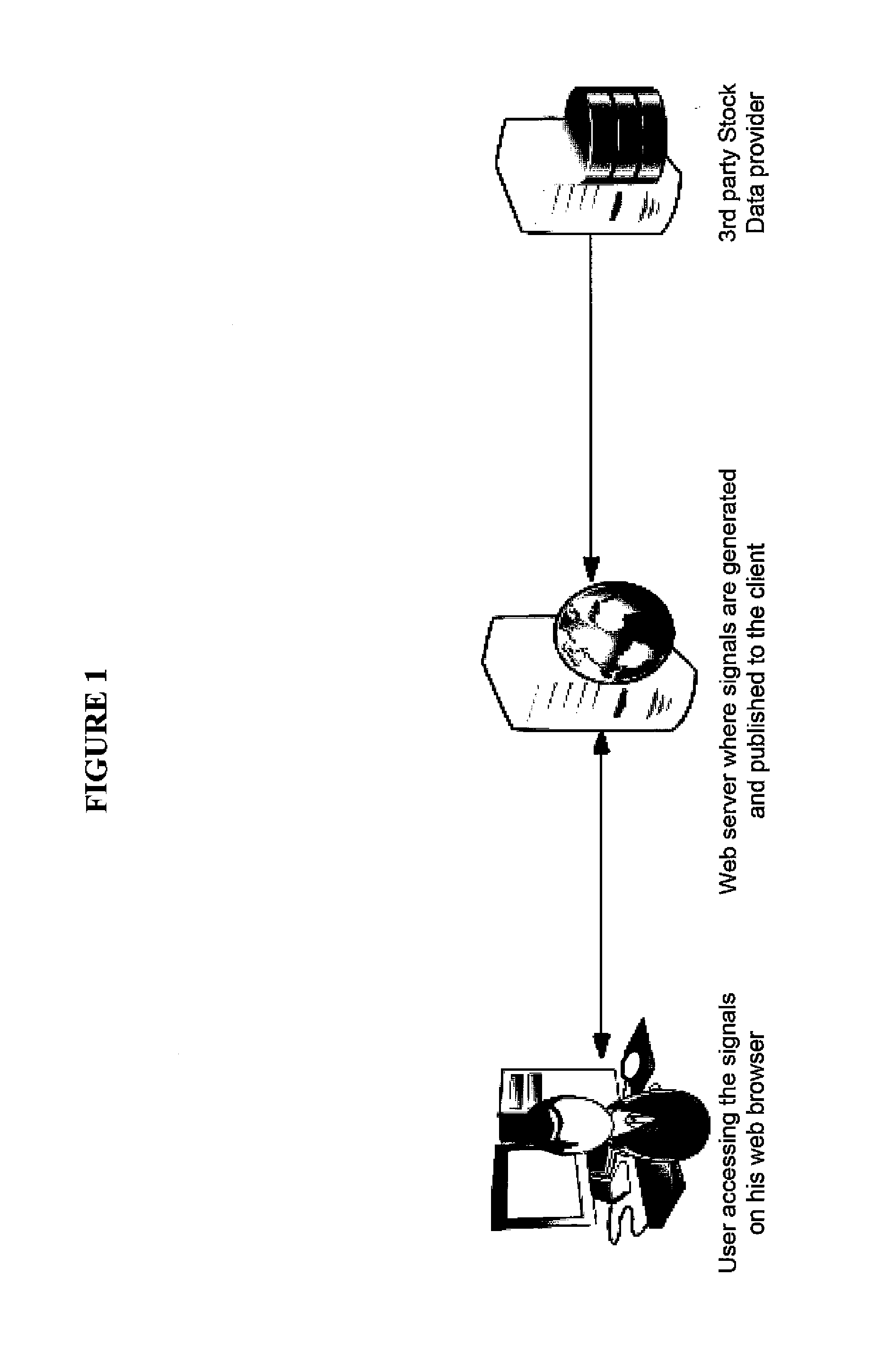

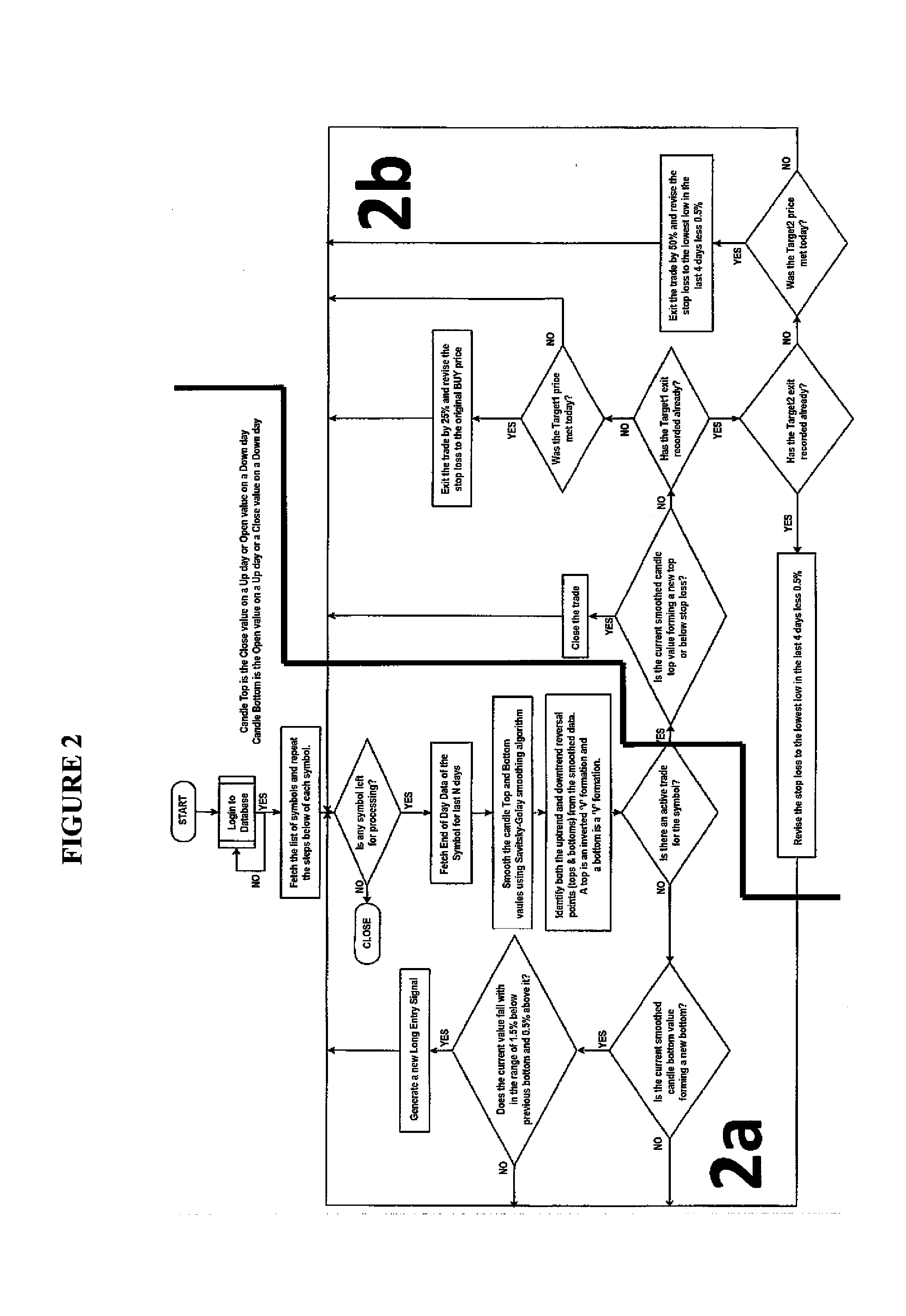

Method for trading stocks

The present invention provides a trading system with very high percent success rate in market by means of minimizing the risk. This invention provides an easy and simple-to-use system for swing trading. This system is automated and based on an algorithm which uses the end of the day data for particular financial instrument to generate buy / sell signals for selected stocks. These signals provide the precise entry and exit points in the markets for those particular stocks. The signals come with a small stop loss to ensure safety of the investment. The system provides three exit levels to ensure that the investment risk is minimized and profit is reaped.

Owner:INCREDIBLE SIGNALS

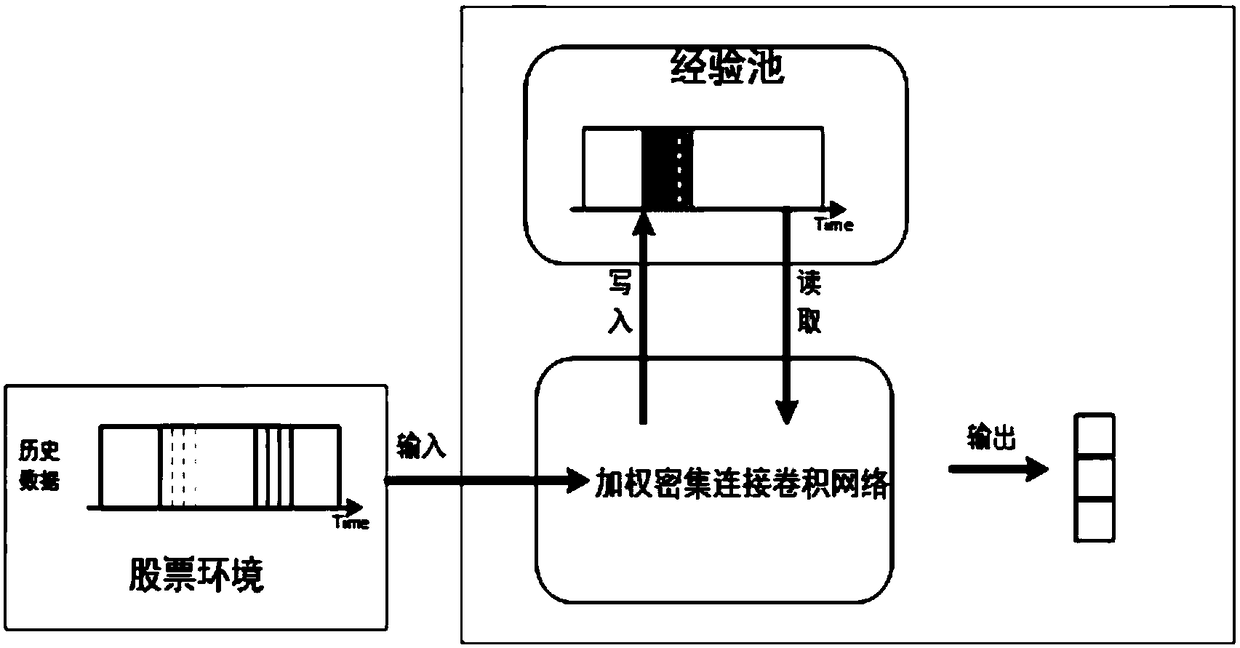

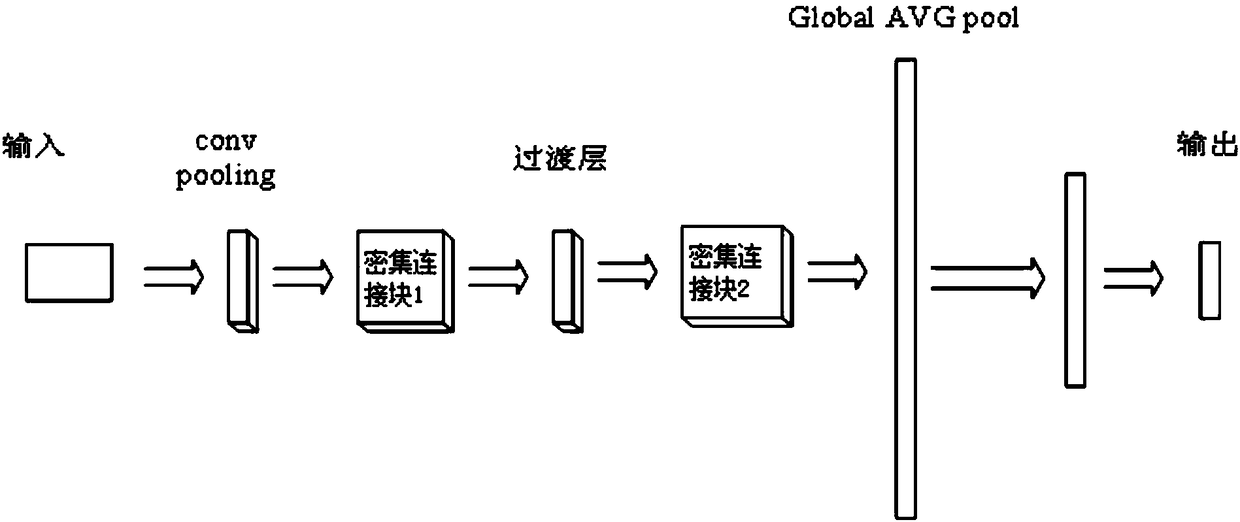

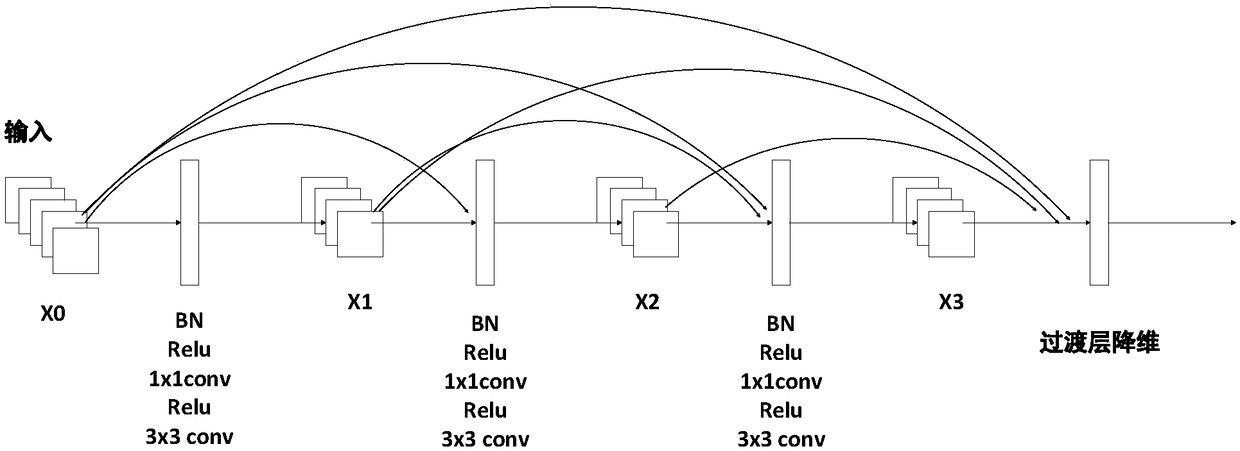

Stock investment method based on weighted dense connection convolution neural network deep learning

InactiveCN108090836ASmall sizeMaximize featureFinanceNeural architecturesFeature extractionDecision taking

The invention relates to a stock investment method based on weighted dense connection convolution neural network deep learning. According to the method, feature extraction is conducted on input stockdata through weighted dense connection convolution, different initial weight values are endowed with dynamic adjustment weight values in the training process through cross-layer connection and featurepatterns of different layers, the feature patterns are more effectively used, information flow between all layers in the network is increased, and the problem that the layer is too deep and thus convergence of gradient disappearance results in the training process is difficult is solved to some extent. Through the Q value output by the weighted dense connection convolution network, appropriate stock trading action is selected, a corresponding reward value is obtained, the reward value and states are stored in a experience pool, at the time of training, batch sampling is randomly conducted inthe experience pool, and the weighted dense connection convolution neural network is used for approaching a Q value function of the Q-learning algorithm. By directly learning the environmental factorsof a stock market, a trading decision is directly given.

Owner:NANJING UNIV OF INFORMATION SCI & TECH

Computer software and system for automatic stock dealings

A computer readable medium is configured with instructions for causing a first computer system connected to a computer system of stock exchange market via a data communication network to automatically place a series of stock trade orders. The first computer system can include, for instance, a user computer, a brokerage computer, or both. An automated system for systematically and repeatedly placing stock trade orders based on predetermined conditions is also provided. In general, the automated system or computer system running the software operates by receiving and storing an automatic stock trading condition. A stock trading order can be placed immediately following a previously contracted order, or when a stock market status satisfies the preset stock trading condition. The first computer system preferably receives user input including basic information such as an item code of the stock and an account number of a stockholder. Automatic trade condition information can also be input into the first computer system by the user or a broker and preferably provides information for determining a desired selling price and quantity and / or a desired purchasing price and quantity for trading of the stock. Market data, preferably including the stock price is received into the first computer system via the data communication network, such as from the stock exchange market computer system. The first computer system can then determine whether a stock purchase or sale condition generated using the automatic trade condition information has been met and place a stock purchase or sale order via the data communication network when the stock purchase or sale condition is met. This system can systematically repeat the process using the automatic trade condition information as a guide for trading. The process can be repeated continuously or can be stopped when a predetermined condition is satisfied.

Owner:CHA MIN HO

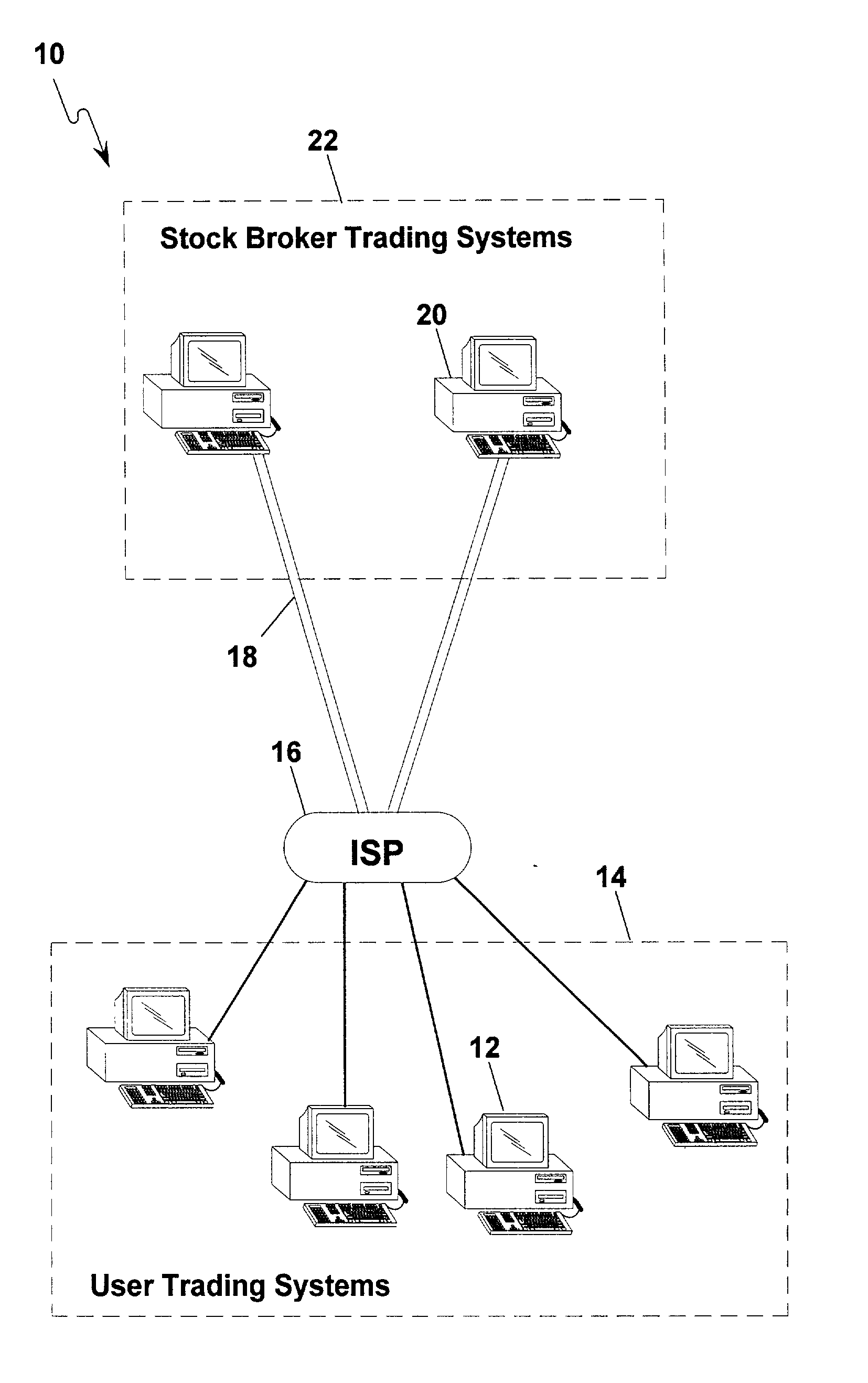

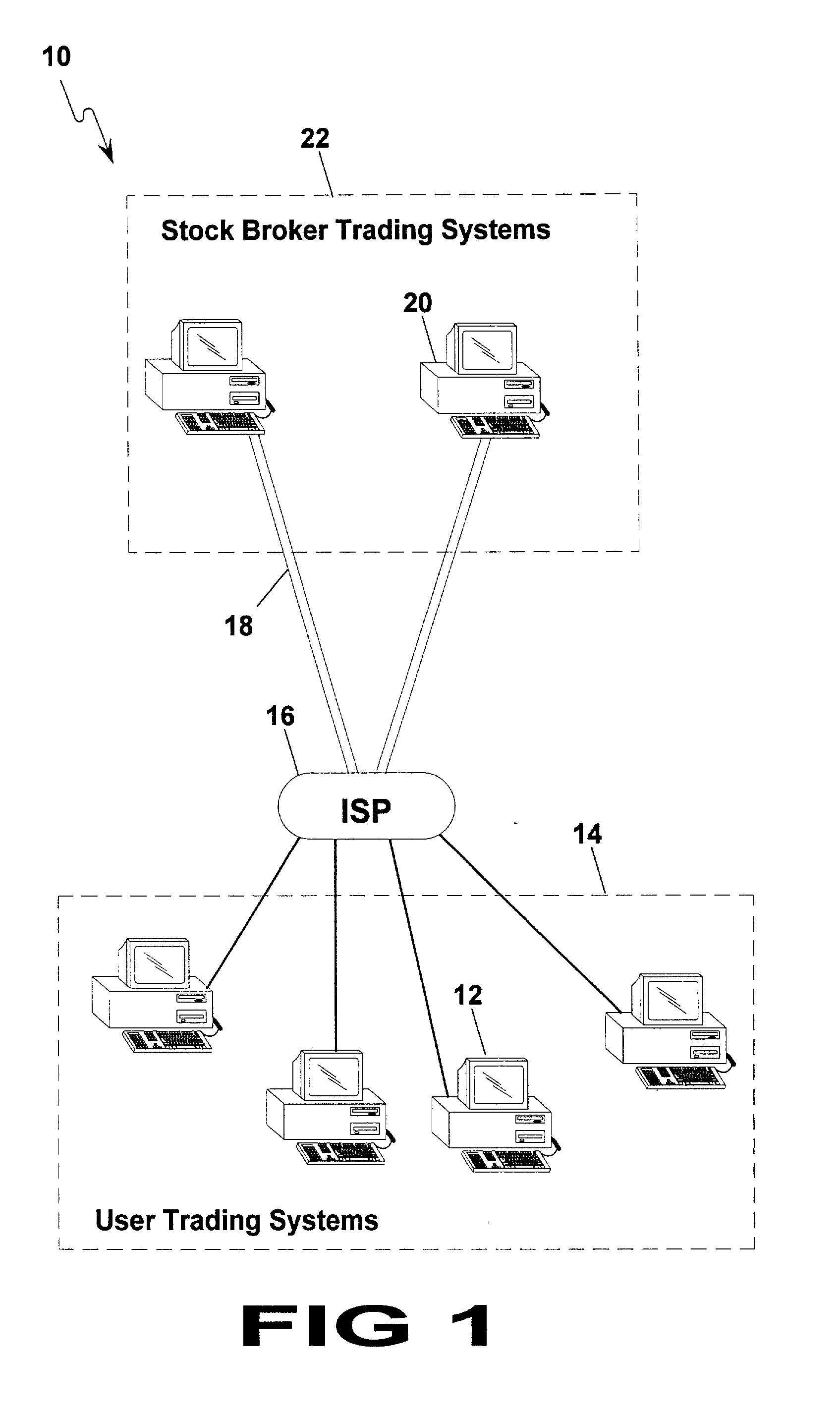

Hypertext transfer protocol application programming interface between client-side trading systems and server-side stock trading systems

The present invention is a software program that modifies a client-side stock trading system fill orders to market orders that are transmitted to a remote broker trading system. The modification will synchronizing a users desktop trading system with a stockbrokers remote system. The HTTP-API (hypertext transfer protocol application program interface) provides client side users with the ability to use the computer resources of a remote server computer to effect transaction processing and / or the transfer of information from one computer to another without having the absolute need for a web browser, plugins or software languages contained within the server system.

Owner:DEMING DOUGLAS R

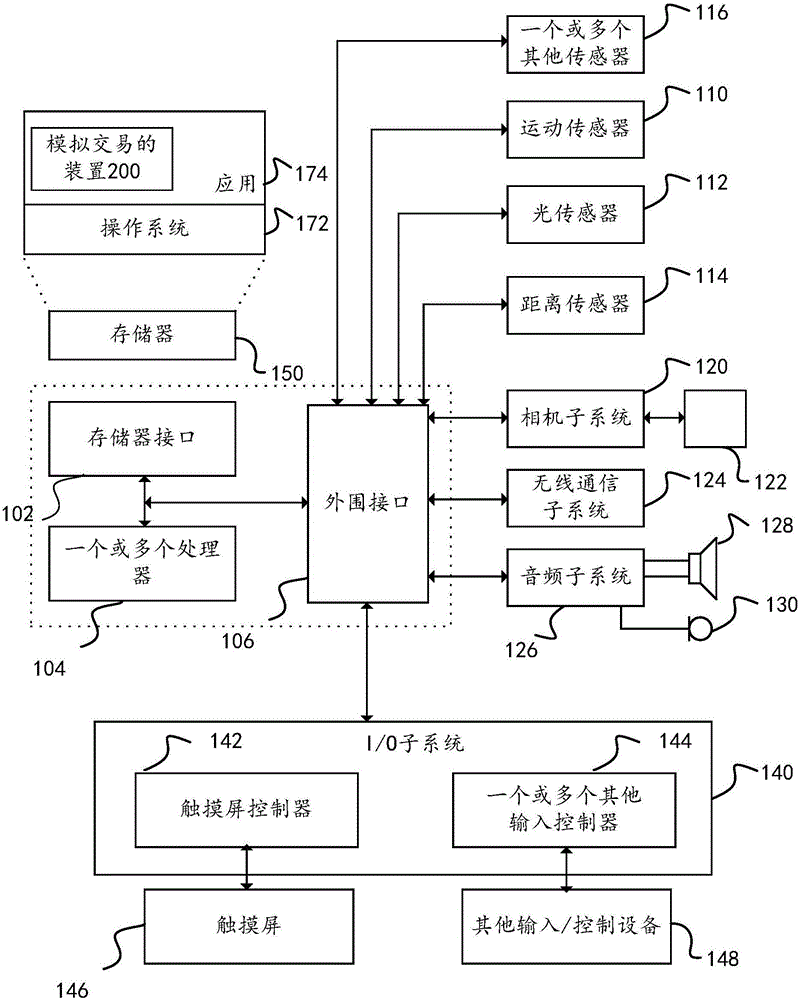

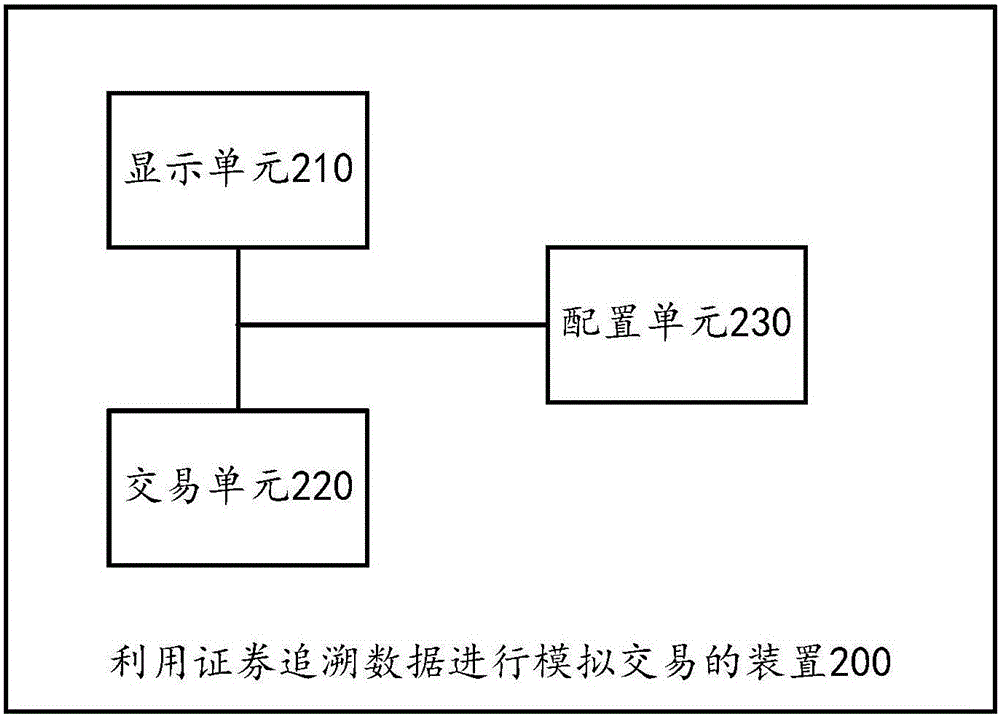

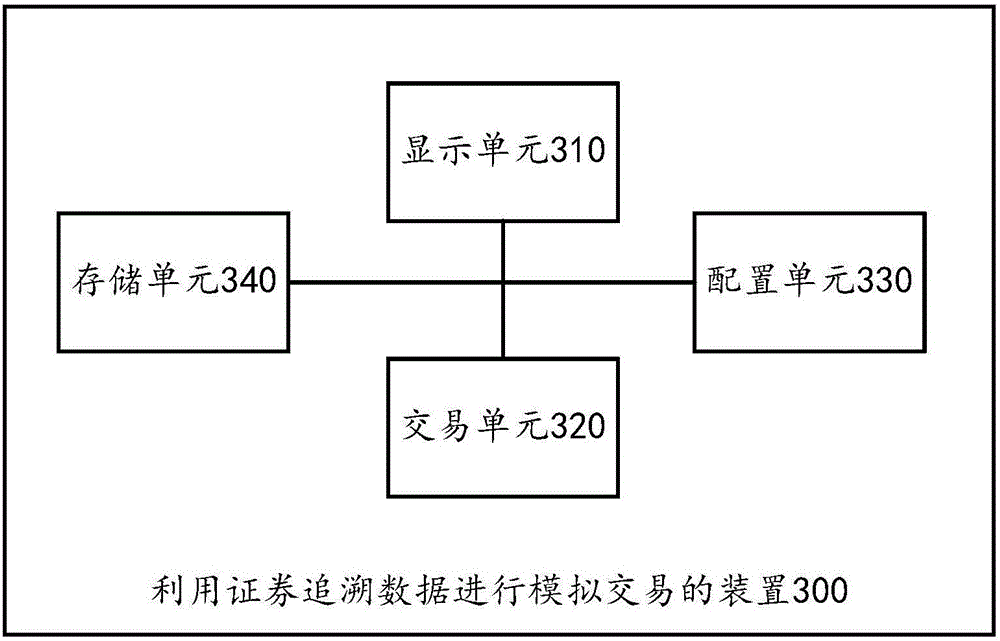

Method, apparatus and calculation equipment for simulated stock trading by using securities back traced data

The invention discloses a method, an apparatus and calculation equipment for simulated stock trading by using securities back traced data. The apparatus for simulated stock trading is suitable to be applied in a computing device. The apparatus comprises a display unit and a trading unit. The display unit, starting from a historical period of a simulated transaction, updates in order and presents the historical data of at least one stock along with a progressing process in a certain time unit. The historical data of each stock comprises at least one of the following items: K line parameters, indexes parameters, bidding prices, financial data, news, major stock holder's holding information, and financial indexes. The trading unit allows a user to trade stocks according to the trading instructions a user inputs. It also records corresponding transaction results.

Owner:HAINAN SHIJIALIANG TECH CO LTD

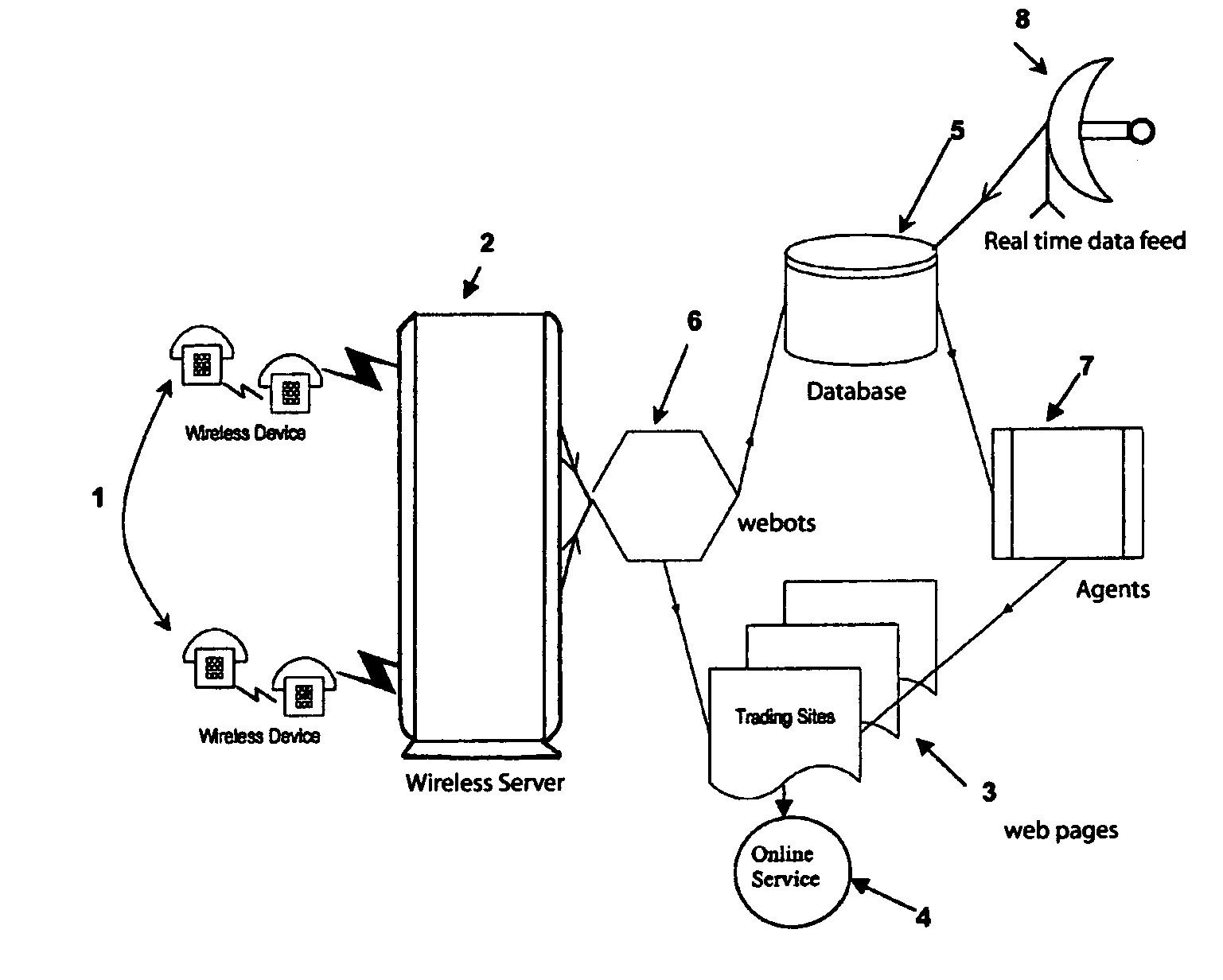

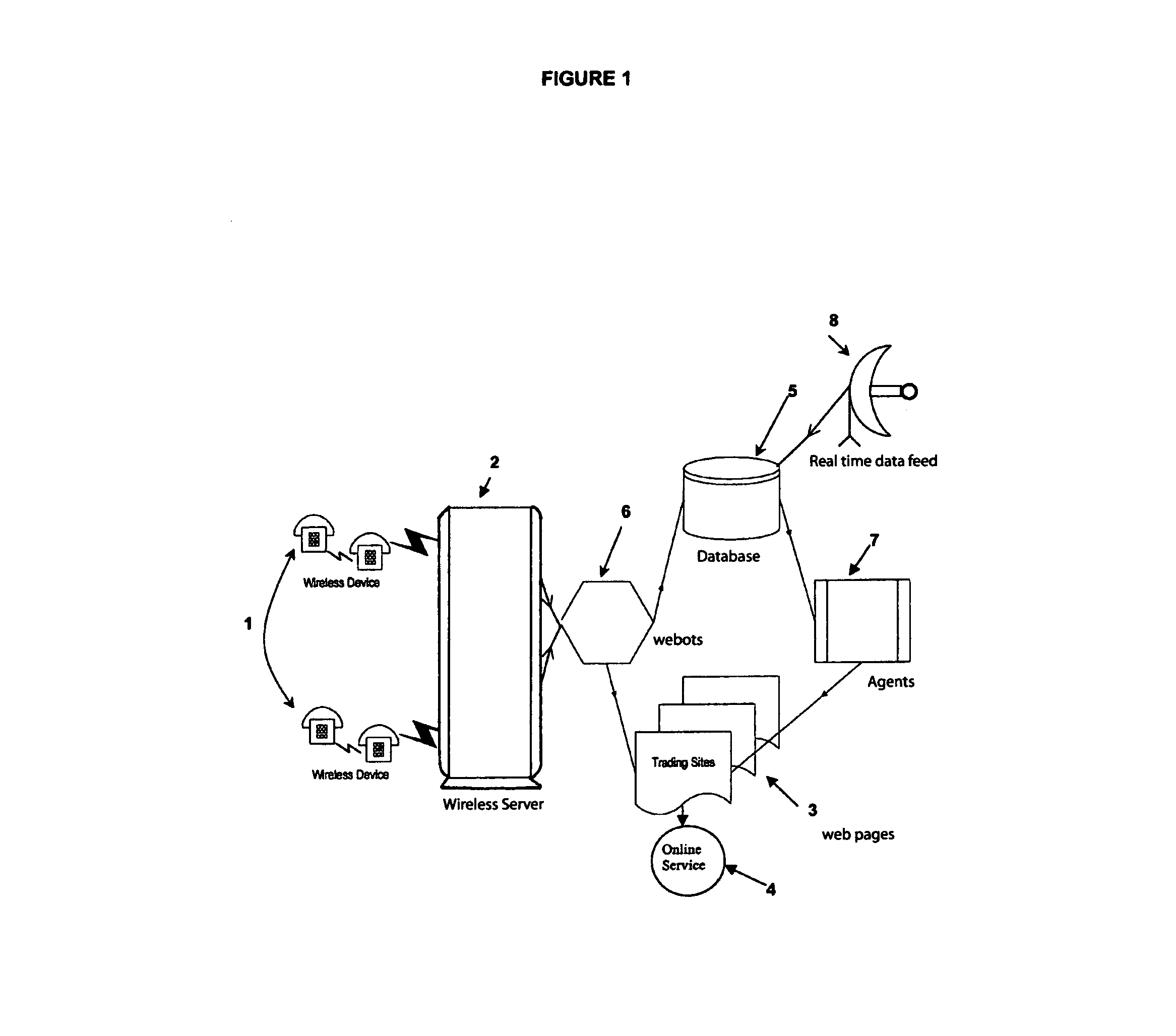

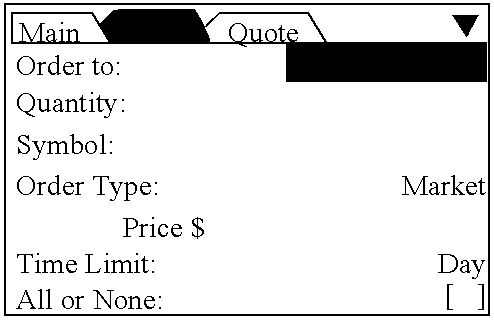

Interactive wireless devices to on-line system

A two-way wireless device and wireless internet system is adapted for interactive communications between a subscriber using a wireless device, a wireless server, and an on-line service using a web page for the input of information. Systems are disclosed for stock transaction trading wherein a subscriber, using wireless E-mail or a pager, interfaces to any one of numerous on-line stock trading services through a wireless server which uses agents, artificial intelligence software subroutines, which have been programmed to interact like a human using a web site, for E-mail alerts and stock trading.

Owner:C H I DEV MGMT LTD XVIII

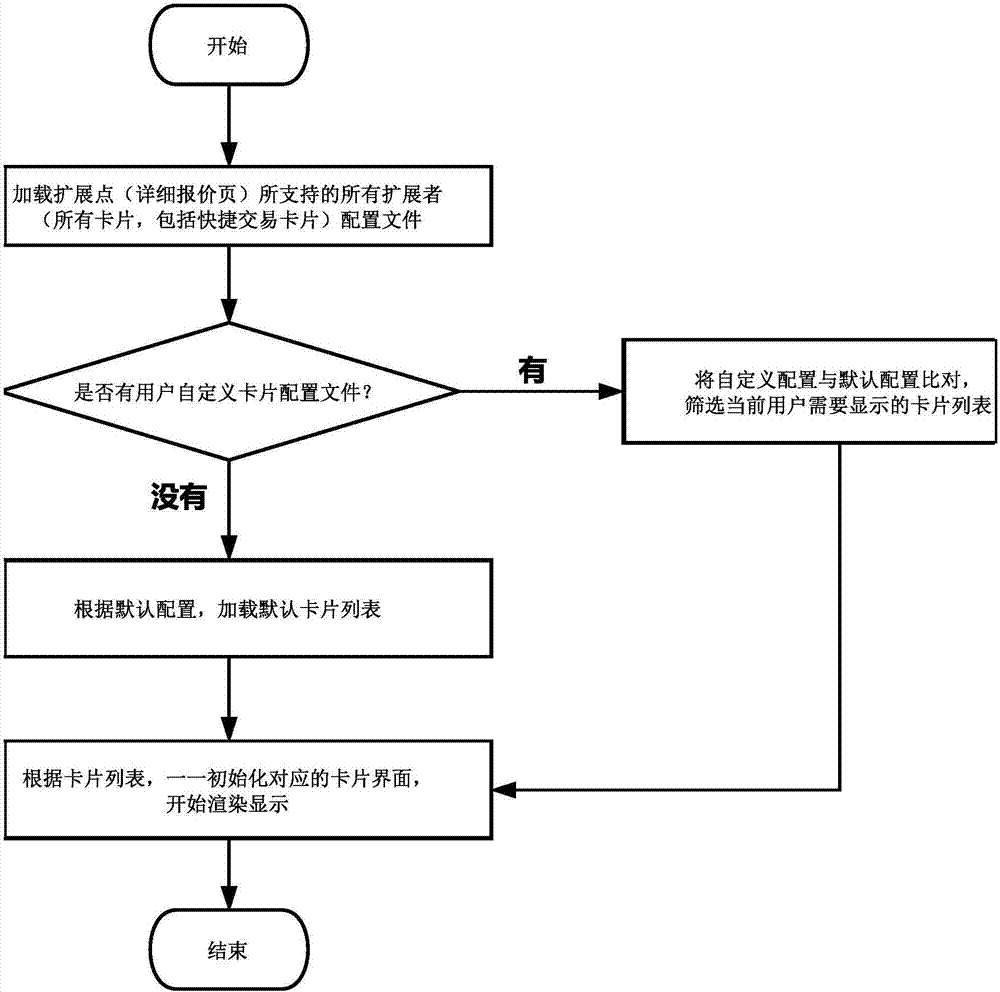

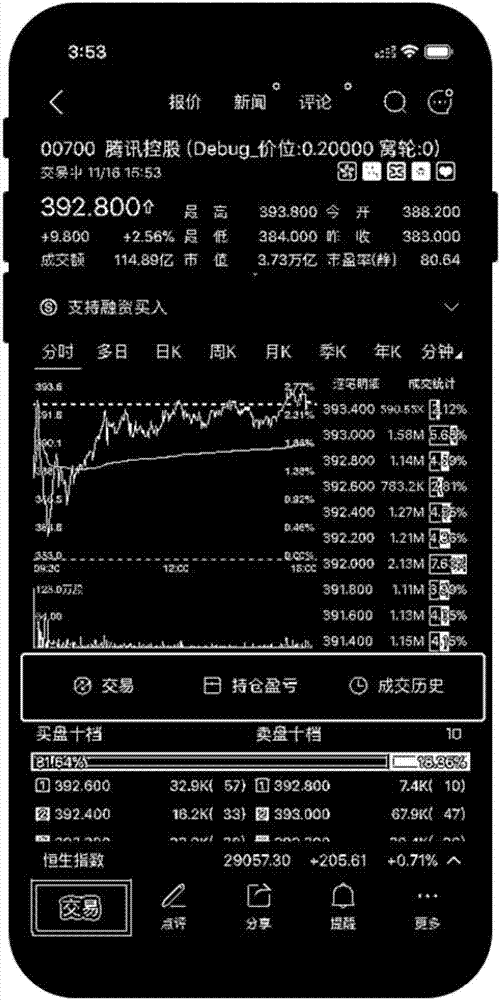

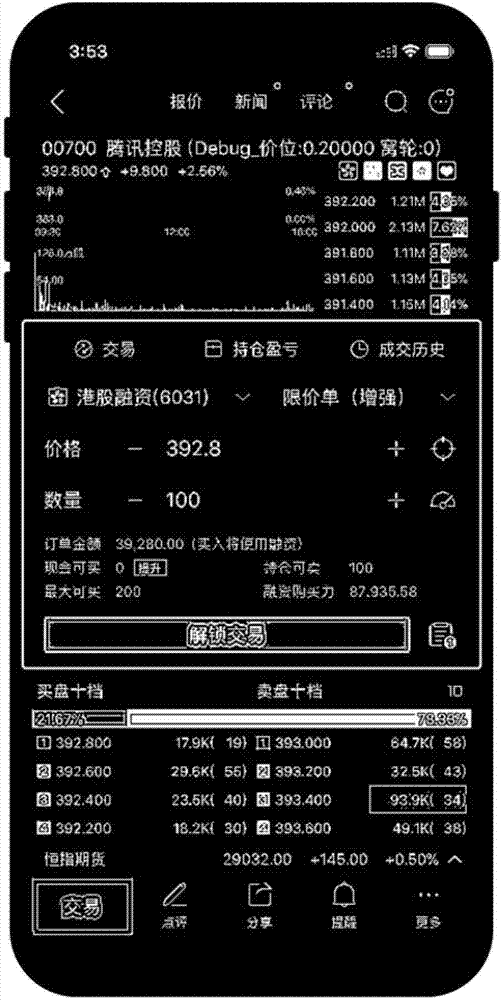

Quick action card display method of detailed quotation page of stock trading software

InactiveCN108009923AImprove efficiencyHigh speedFinanceBuying/selling/leasing transactionsComputer hardwareComputer science

The invention discloses a quick action card display method of a detailed quotation page of stock trading software. The quick action card display method of a detailed quotation page of stock trading software includes the steps: S1, opening a stock detailed quotation page, and loading default card configuration files of all quick action cards supported by the stock detailed quotation page; S2, determining whether user defined card configuration files exist, if so, executing the step S3, and if not, executing the step S4; S3, screening quick action cards which are required to display by the userat present, and then executing the step S5; S4, according to the default card configuration files, loading the quick action cards; S5, initializing the interface areas corresponding to the quick action cards in the stock detailed quotation page; and S6, displaying the quick action cards in the interface areas in the stock detailed quotation page. The quick action card display method of the detailed quotation page of stock trading software enables the quick action cards to be unfolded and folded through card type arrangement, thus being convenient for the user to timely and accurately make a transaction decision when the user browses the market.

Owner:SHENZHEN FUTU NETWORK TECH CO LTD

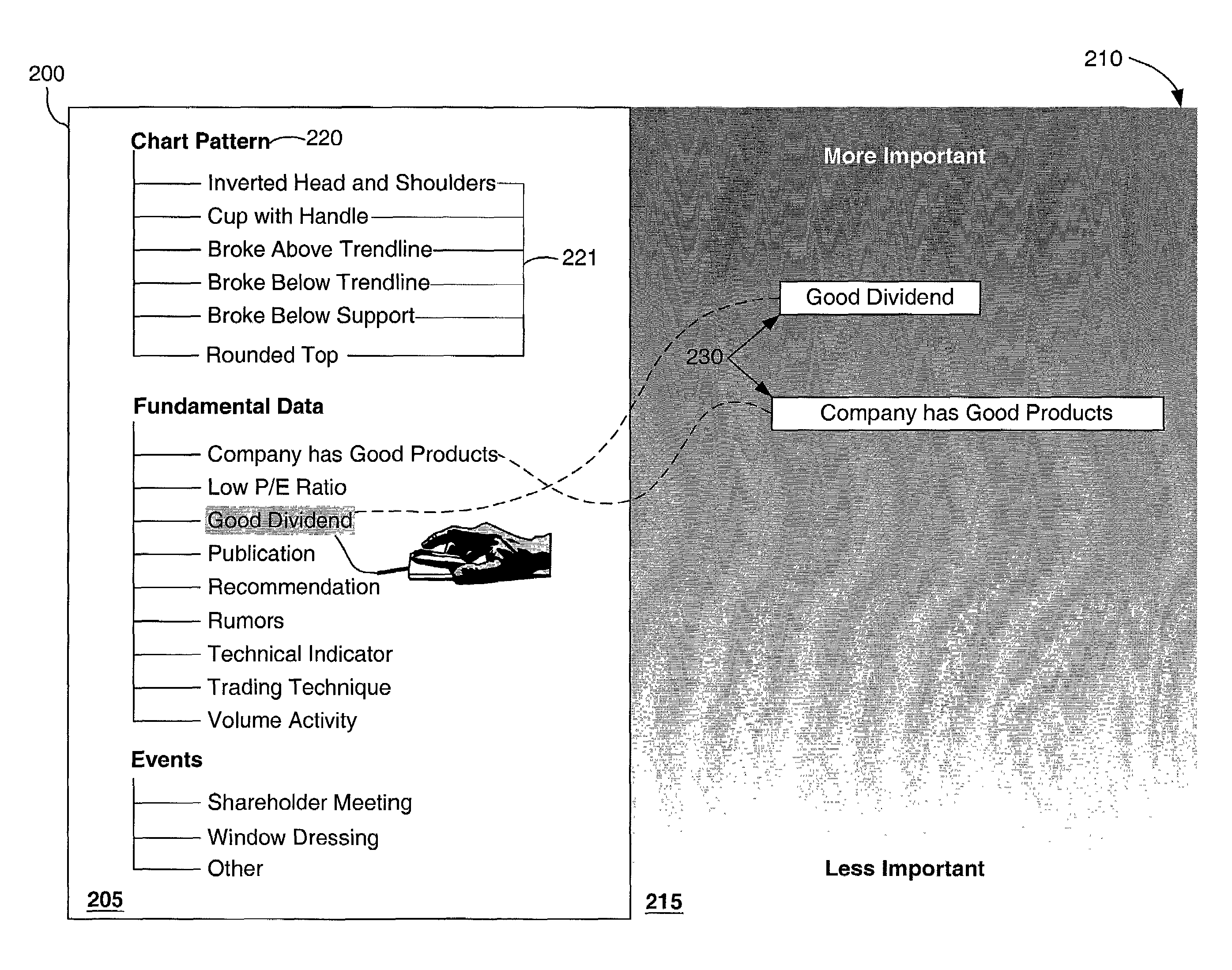

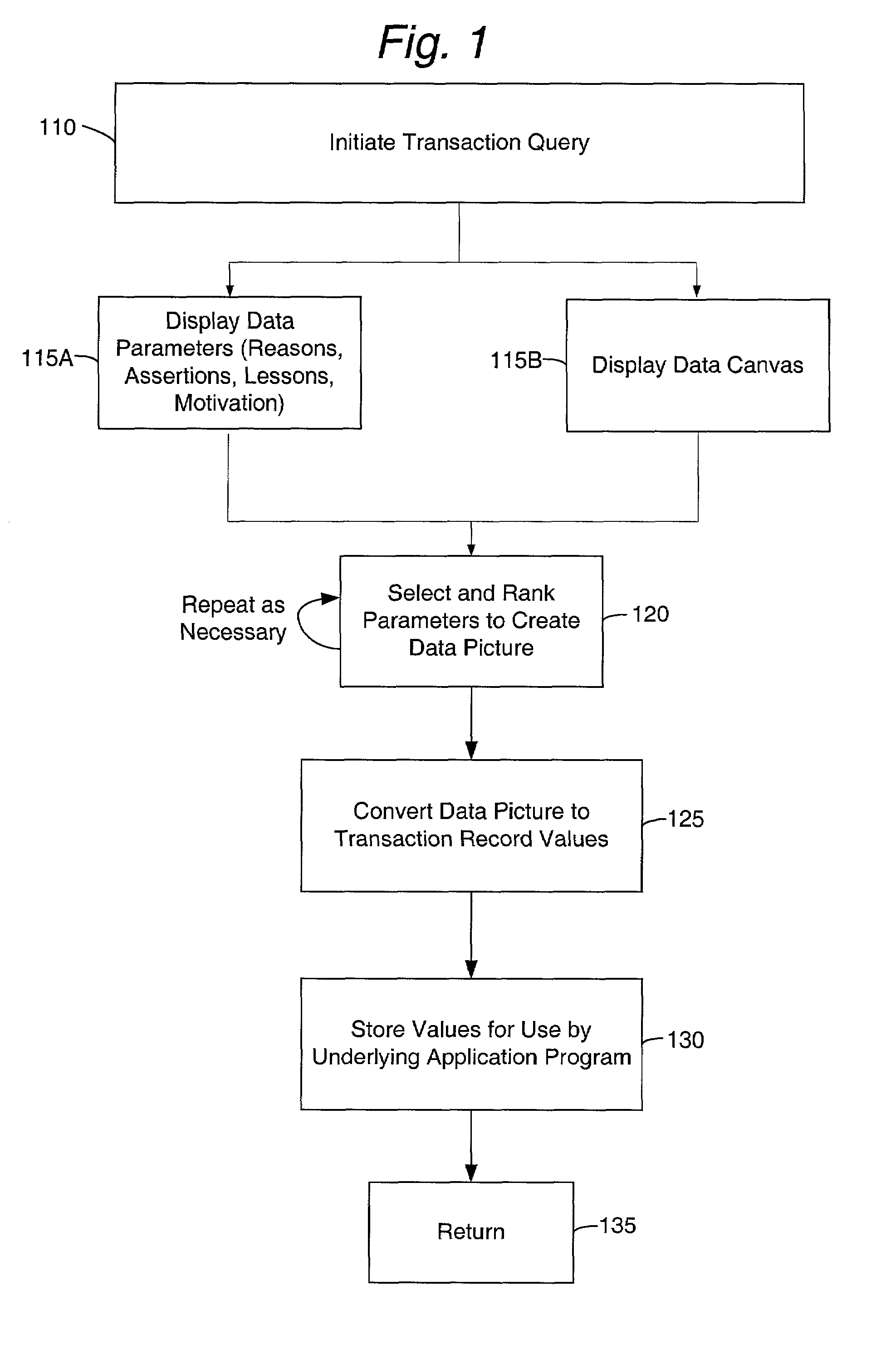

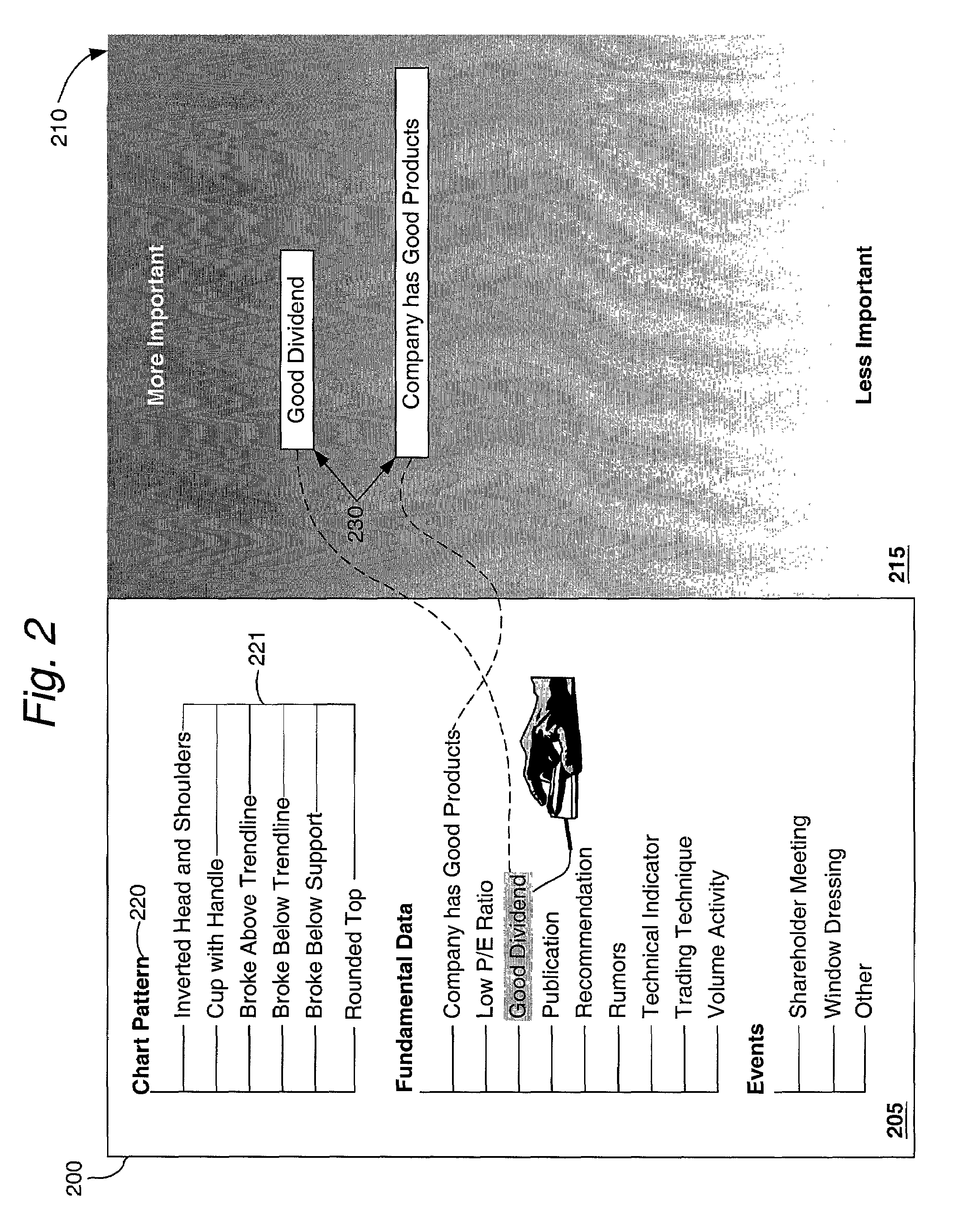

Stock trading application program

InactiveUS7478063B2Quick and efficientSimple procedureFinanceDigital computer detailsFinancial transactionData mining

A stock trading application program which executes within an Internet browser is provided for capturing user specified subjective information concerning user rationale and logic for purchasing or selling financial instruments such as securities, options, etc. The subjective information is stored as data records which can be examined, analysed and correlated to assist a user in determining whether to engage in particular trades.

Owner:ROVI TECH CORP

Multi-account management login system

The invention discloses a multi-account management login system, which comprises a login interface, wherein an account input information bar and a password input information bar are arranged above thelogin interface; a login button is arranged at the lower end of the password input information bar; an overseas mobile phone number login bar is arranged at the left lower end of the login button; and a WeChat login interface, a QQ login interface, a Sina microblog login interface, a Facebook login interface and a Twitter login interface are sequentially arranged below the login interface from left to right. According to the multi-account management login system provided by the invention, one APP can be logged in through a plurality of accounts, a user can use the accounts to carry out stocktrading on a Futunn APP, and meanwhile, operations such as deletion and addition of multi-account management and opening and closing of multi-account management switching are carried out on a settingpage, the user can log in to a stock trading APP quickly, the different accounts can be quickly switched for login, the login time of the user is shortened, and the account can be conveniently managed.

Owner:SHENZHEN FUTU NETWORK TECH CO LTD

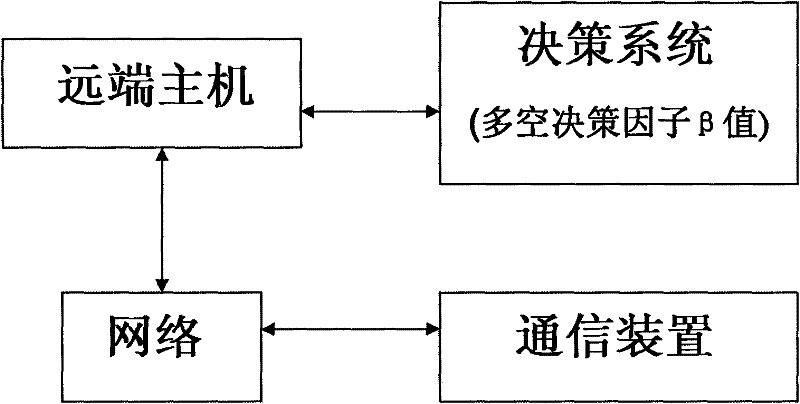

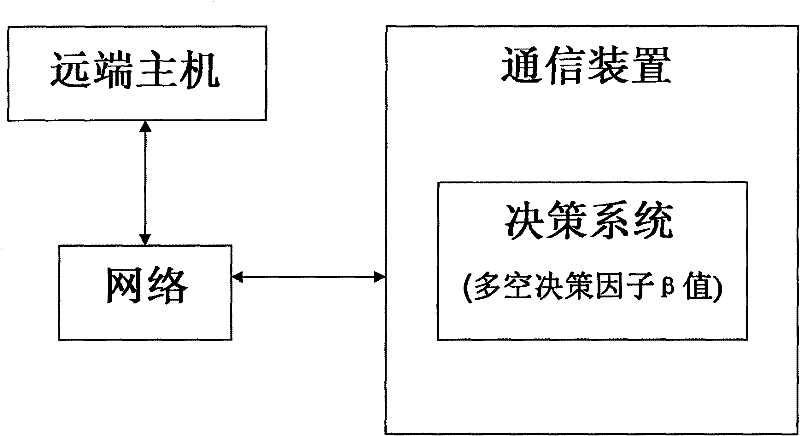

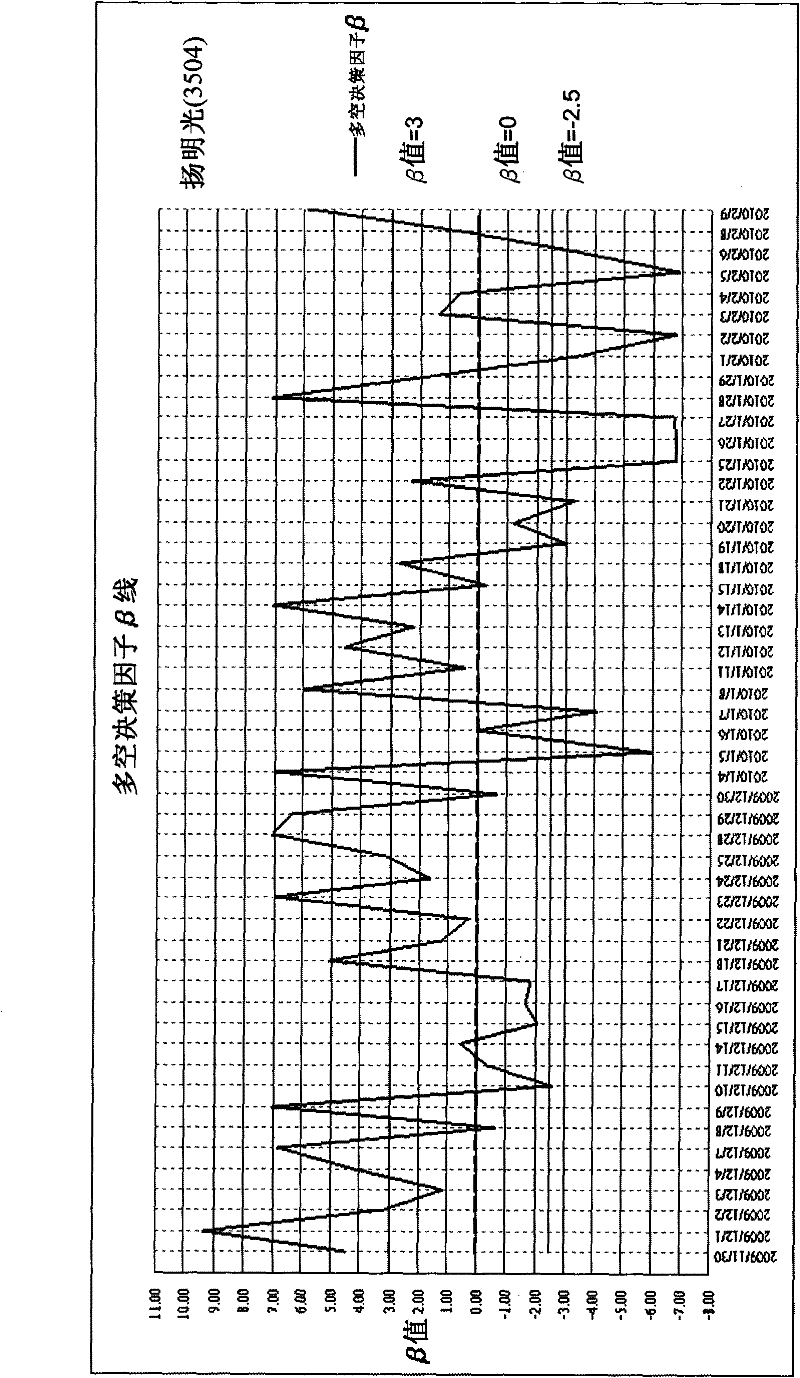

Stock long and short buying and selling decision-making system

The invention provides a long-short stock trading decision-making system. The system abandons the untimely historical data simulation calculation method, and can quickly integrate and analyze the real-time data of "yesterday's closing" and "today's intraday" of the market and individual stocks in the stock market through the computer, and use the calculation model of the "stock long-short decision system" , constantly track the increase and decrease of individual stocks relative to the stock market volume, the strength of the opening of the day, the real-time strength of the intraday, and the intraday price amplitude, and quickly calculate a long-short decision factor β in the intraday or after the market, according to the value of β When the change reaches a certain set value, the system will send a long-short trading signal to provide investors with the actual needs of long-short trading decision-making signals, and assist users to accurately and quickly grasp the best buying and selling timing points from a huge number of stocks.

Owner:兆雅股份有限公司

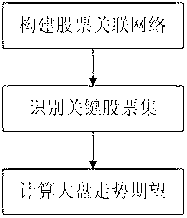

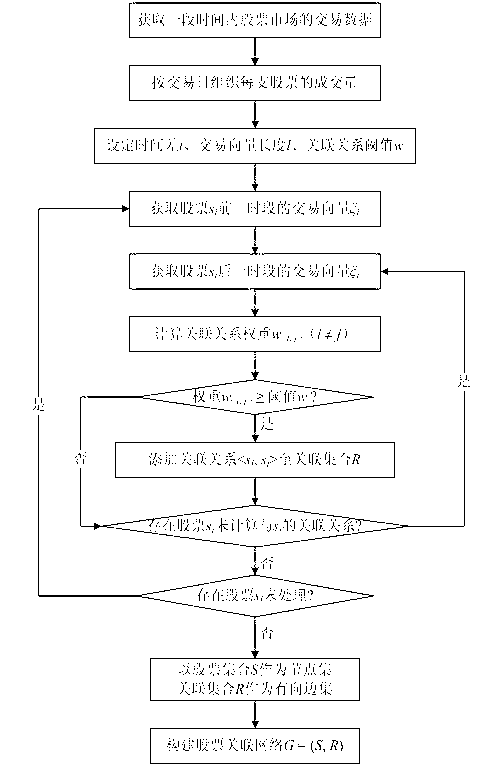

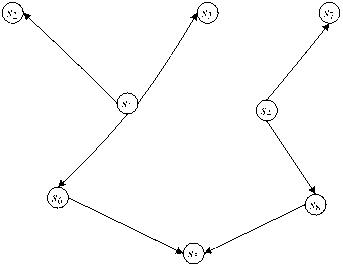

Stock market data analysis method based on key stock set identification

InactiveCN103236013AAvoiding fair game problemsAdjustable and control processing needsFinanceTrend predictionA* search algorithm

The invention discloses a stock market data analysis method based on key stock set identification. The method comprises the following steps that (1) data is collected, the association relationship among the stock trading volume is calculated, and a stock association network is built; (2) in the stock association network, a key stock set is identified by a search algorithm in an iteration mode; and (3) the market trend expectation is calculated by using the trading volume as the weight according to the key stock price trend. The method has the advantages that the association relationship among the stock trading volume is fully excavated, stocks which are in an active state and have an influence effect can be accurately judged according to the trading condition of the stock market, and the accuracy of the stock market trend prediction is improved. The calculation is simple, timeliness, flexibility and expansibility are realized, the historical data processing requirement can be regulated, and the method is suitable for conditions with great stock market data quantity and frequent stock trading changes.

Owner:NANJING UNIV

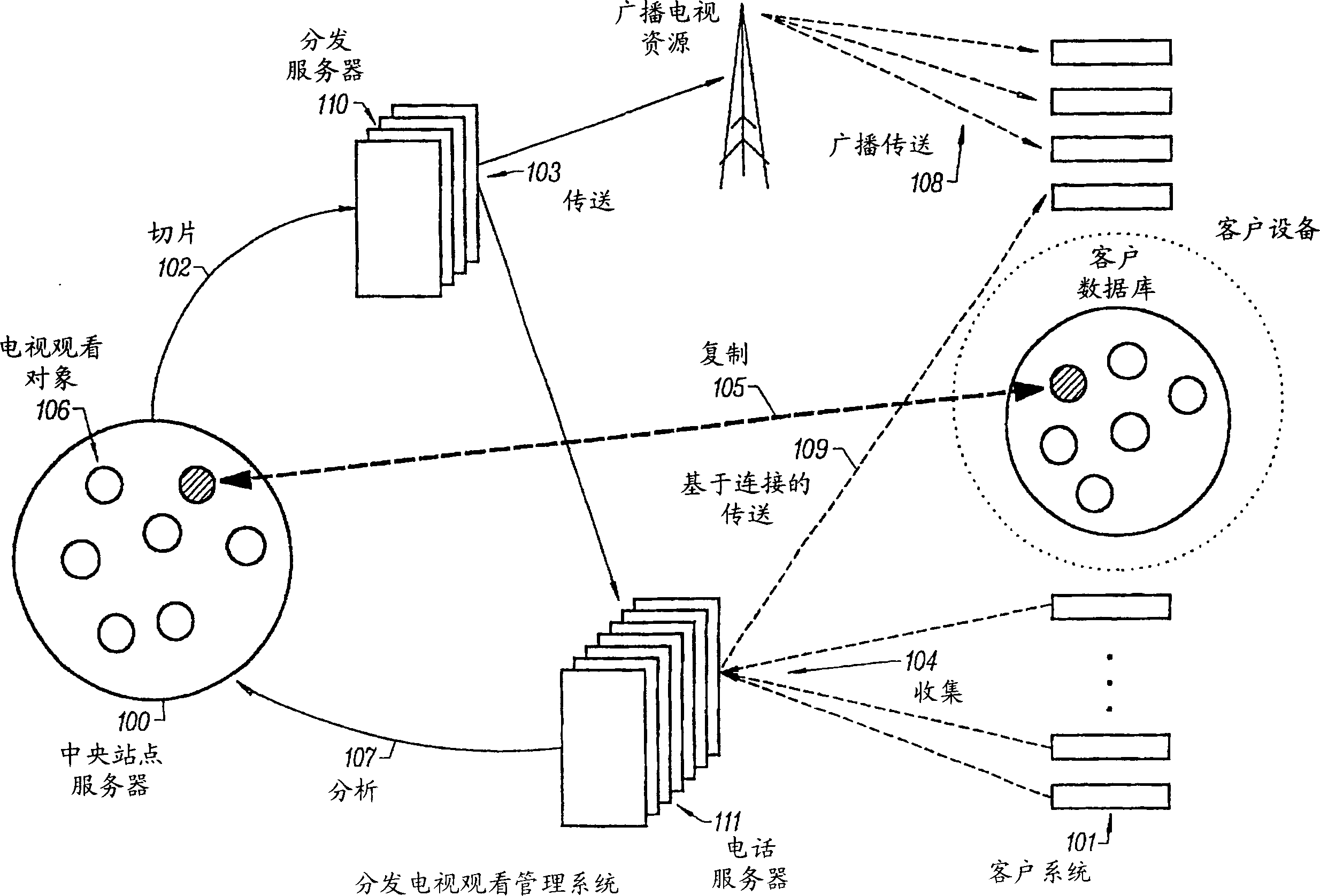

Electronic content distribution and exchange system

InactiveCN1613084AReliable downloadSecure Content DistributionDigital computer detailsUnauthorized memory use protectionBroadcast channelsServer log

An electronic content distribution and exchange system provides authenticated, reliable content downloads and tracking capabilities. Content is distributed to users through the invention's architecture. A user registers for the purchase of content through an interface on a client system or via a Web site. The purchase is for a license to the content, not for the content itself. A list of available content is displayed to the user through the client system or the Web site. The invention's central servers log the purchase of the content into a licnese database. The electronic copy of the song may be already resident on the client system in a hidden area, carouseled in a protected broadcast channel, in the central database ready to be sent out in slices, or resident on a secure server on the Internet. The user accesses content through the client system's user interface where the user plays the content and controls its playback. The invention's service provides an exchange capability similar to stock trading whereby owners offer licenses to various electronic for sale. A seller places his license for a particular content up for a particular content up for sale on the central server where a buyer that is interested in teh license places a bid. When a price is agreed to, the inventio's central server transfers license ownership in the license database to the new owner.

Owner:TIVO INC

Stock client side

InactiveCN103544649AQuickly understand the transaction processQuickly Understand RisksFinanceClient-sideStock trading

The invention discloses a stock client side and belongs to the field of software. The stock client side comprises a stock client side body and a mock trading module, the stock client side body is provided with a main operation interface, and users can have good stock trading experience through the mock trading module.

Owner:CHANGSHU HUAAN ELECTRONICS ENG

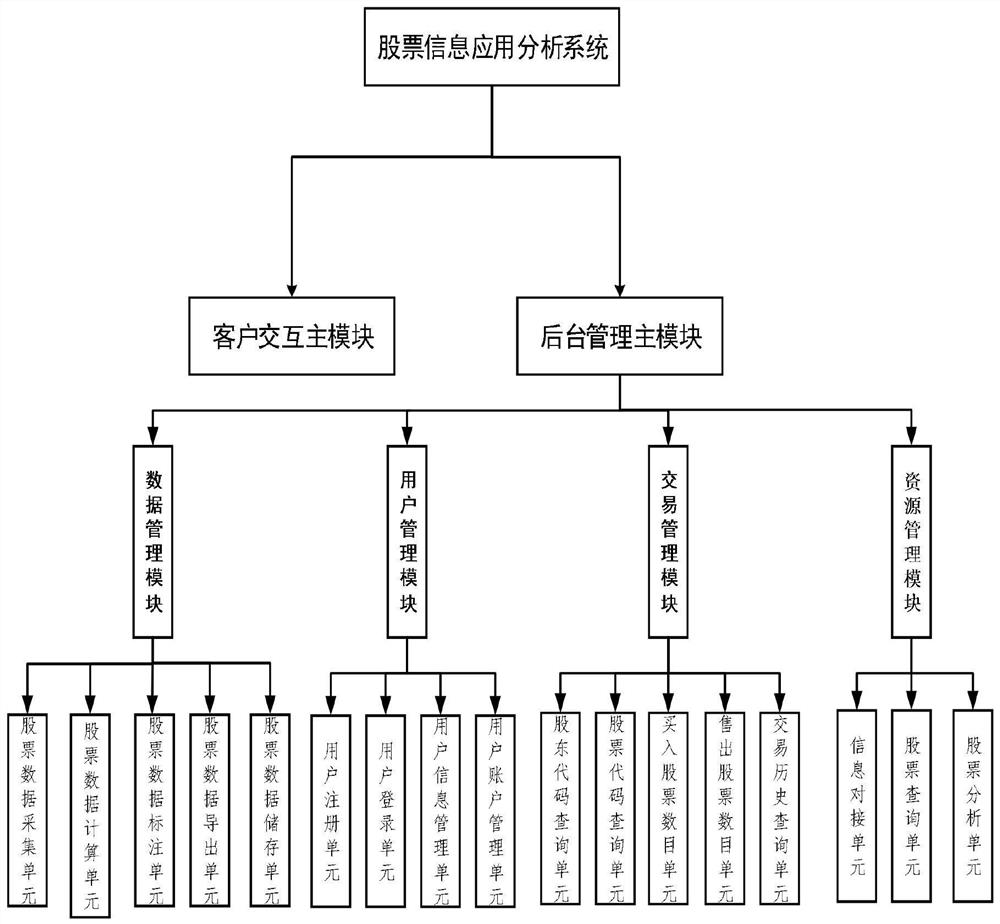

Stock information application analysis system

PendingCN111611487AIncrease profitabilityShort switching timeDigital data information retrievalFinanceEvaluation resultTransaction service

The invention discloses a stock information application analysis system. The method comprises a client interaction main module and a background management main module. The customer interaction main module is used for providing operations of user login, search, stock selection and collection; related plates and stock market information are displayed in an image-text or list form, and specific stockrelated information is displayed; meanwhile, the latest message is pushed according to the market change, and customer service is provided; the background management main module is used for executinguser management, authority management, stock management, customer service, statistical analysis service and stock transaction service. According to the invention, efficient, real-time and comprehensive aggregation of stock messages can be realized; users do not need to open various stock software or pages; each main information module for displaying the stock quotation can be quickly switched toby subscribing the stock in real time, so that the software switching time is reduced, the efficiency is improved, the system logicality is strong, the data is taken into consideration, the accuracy is high, the practicability is strong, and an evaluation result of practical help can be brought to stock investment.

Owner:上海腾韵信息科技有限公司

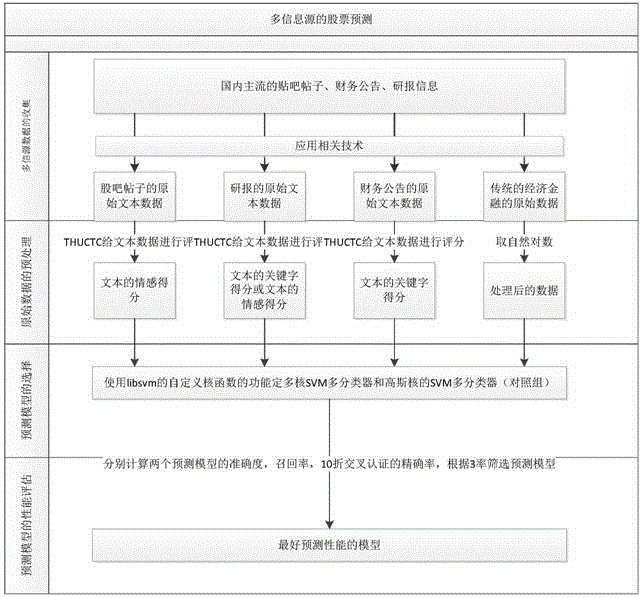

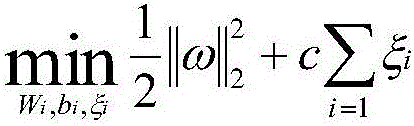

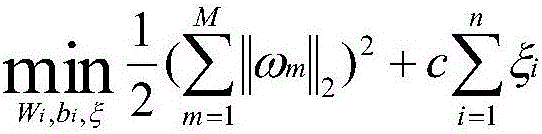

Chinese natural language processing and multi-core classifier based multi-information-source stock price prediction method

InactiveCN106227802ACharacter and pattern recognitionSpecial data processing applicationsNumeric dataMarket change

The invention provides a Chinese natural language processing and multi-core classifier based stock price prediction method and mainly relates to the fields of text message processing, financial sentiment analysis and the like. The Chinese natural language processing and multi-core classifier based stock price prediction method is characterized in that with development of networks and various media, people pay more and more attention to various text data issued through various media, the information published by users also has a certain tendency of stock trading, text type variables have larger influence on the stock market, the text type variables are converted into numeric data by collecting and analyzing multi-information-source stock data, a multi-core classifier is adopted for predicting stock prices, accordingly the internal relation of the tendency and fluctuation of various public opinion and stock movements is revealed, and meanwhile the part which cannot explain stock market change of traditional economical financial variables is supplemented.

Owner:GUANGDONG UNIV OF TECH

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com