Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

86 results about "Price fluctuation" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Price and risk evaluation system for financial product or its derivatives, dealing system, recording medium storing a price and risk evaluation program, and recording medium storing a dealing program

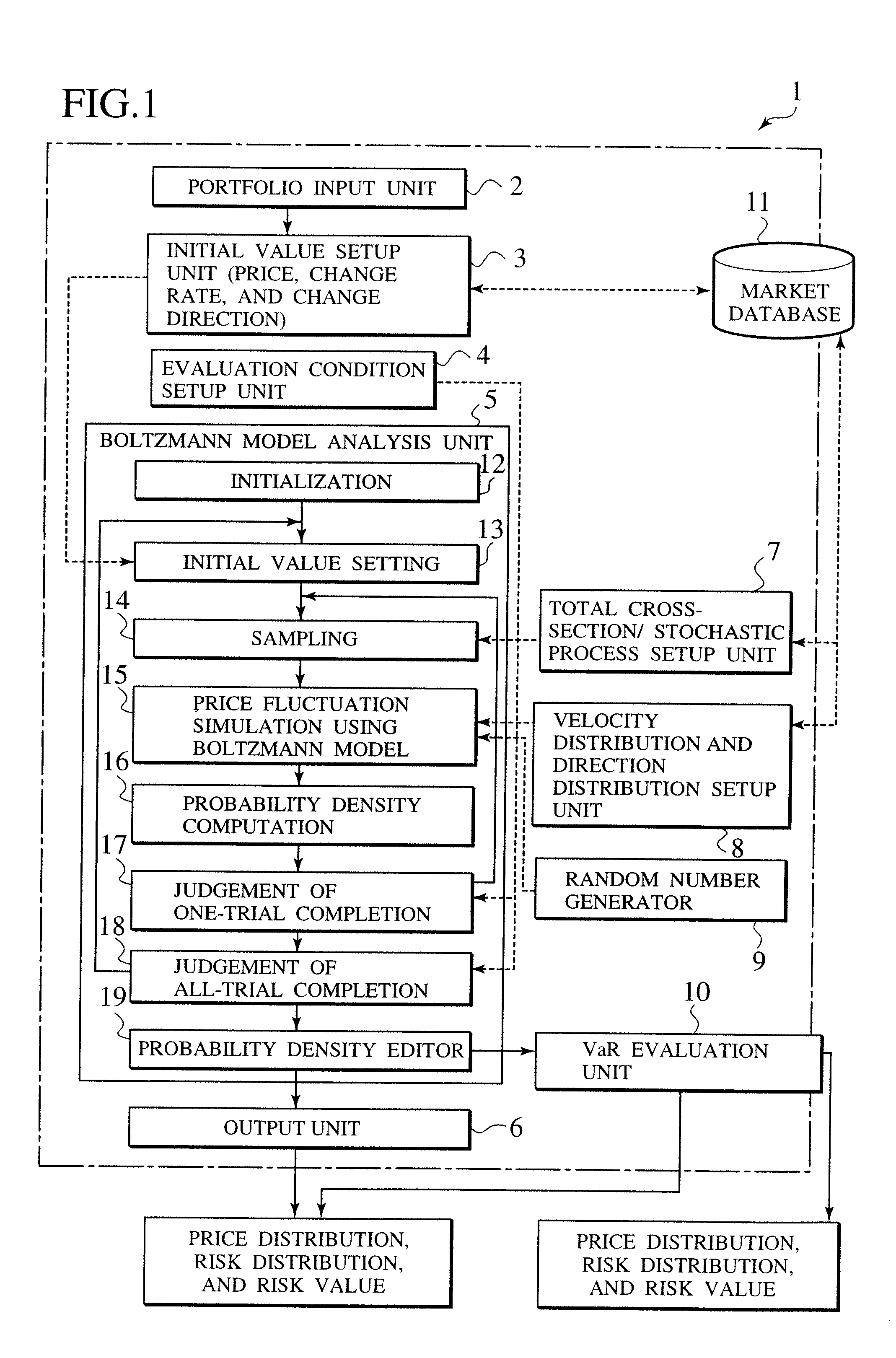

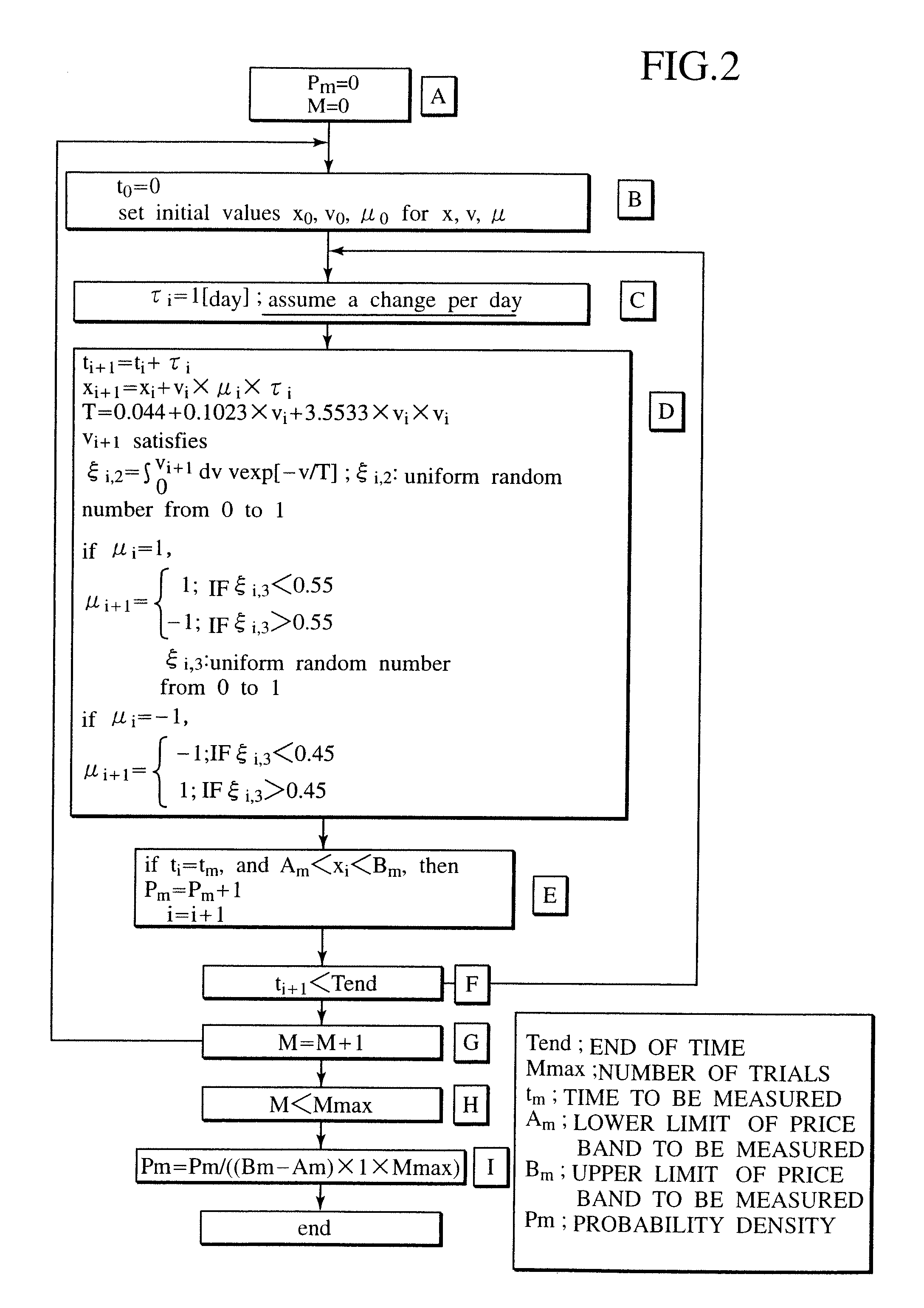

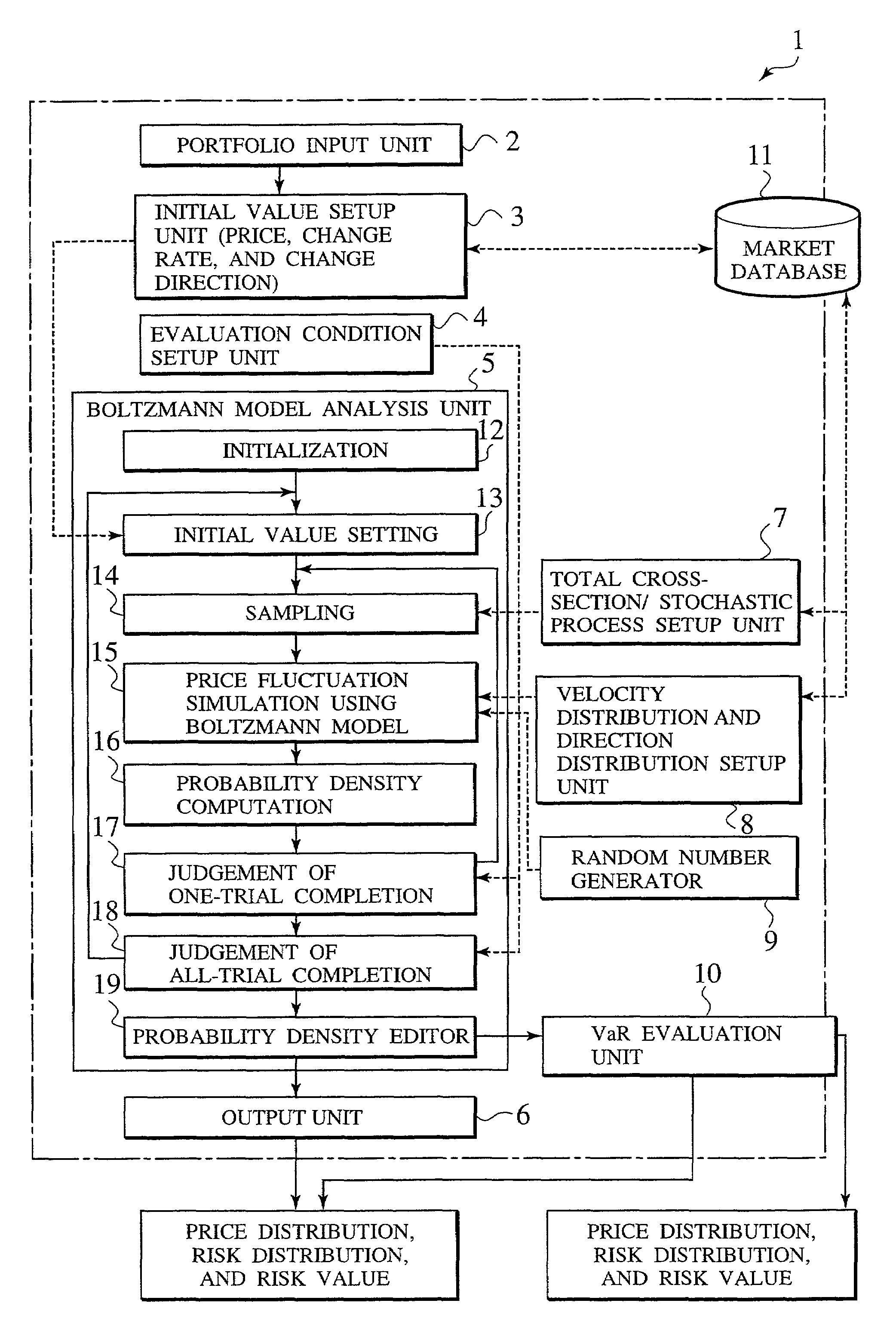

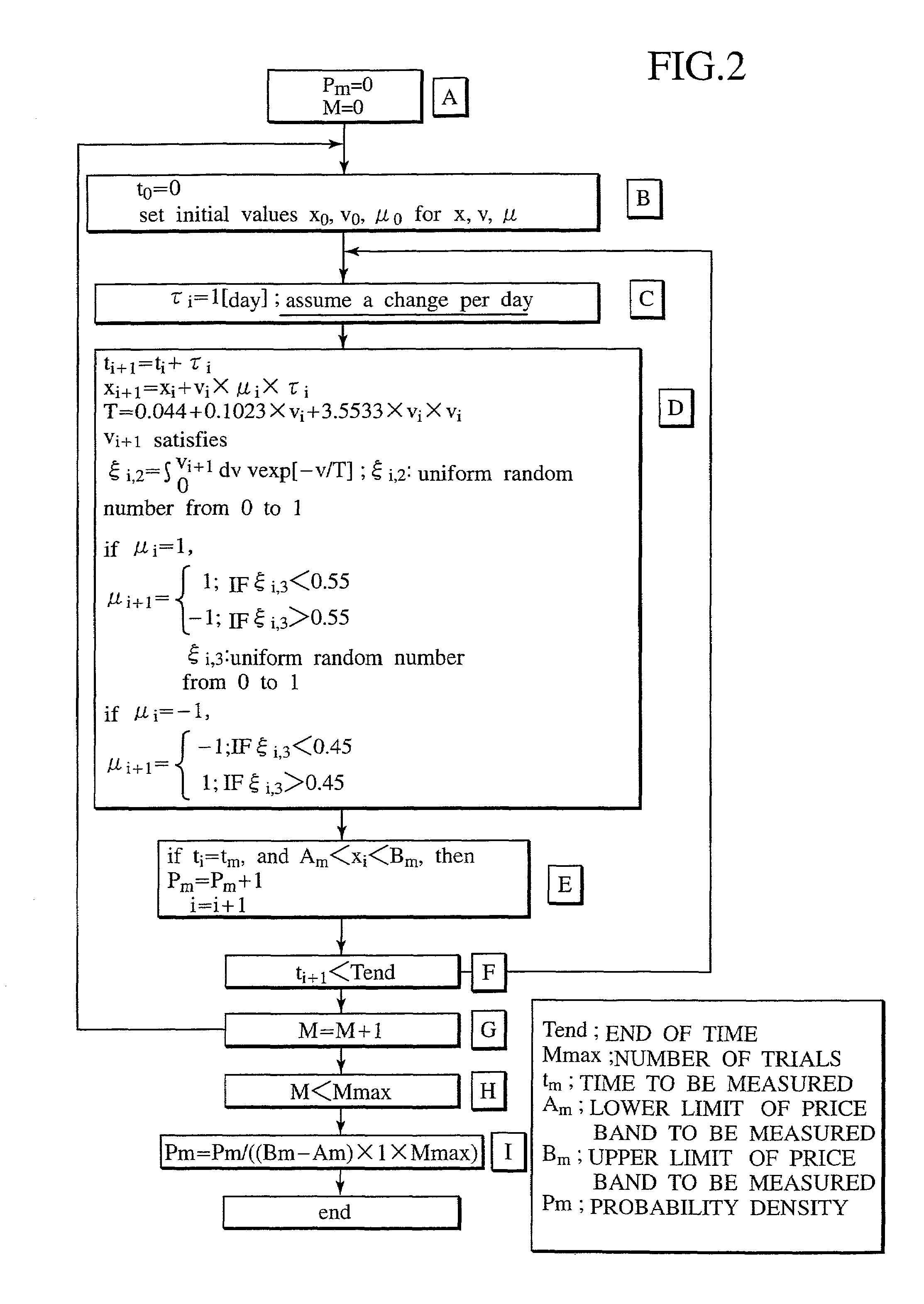

A system for correctly evaluating a price distribution and a risk distribution for a financial product or its derivatives introduces a probability density function generated with a Boltzmann model at a higher accuracy than the Gaussian distribution for a probability density. The system has an initial value setup unit and an evaluation condition setup unit. Initial values include at least one of price, price change rate, and the price change direction of a financial product. The evaluation conditions include at least time steps and the number of trials. The Boltzmann model analysis unit receives the initial values and the evaluation conditions, and repeats simulations of price fluctuation, based on the Boltzmann model using a Monte Carlo method. A velocity / direction distribution setup unit supplies the probability distributions of the price, price change rate, and the price change direction for the financial product to the Boltzmann model analysis unit. A random number generator for a Monte Carlo method employed in the analysis by the Boltzmann model, and an output unit displays the analysis result. A dealing system applies the financial Boltzmann model to option pricing, and reproduces the characteristics of Leptokurcity and Fat-tail by linear Boltzmann equation in order to define risk-neutral and unique probability measures. Consequently, option prices can be evaluated in a risk-neutral and unique manner, taking into account Leptokurcity and Fat-tail of a price change distribution.

Owner:KK TOSHIBA

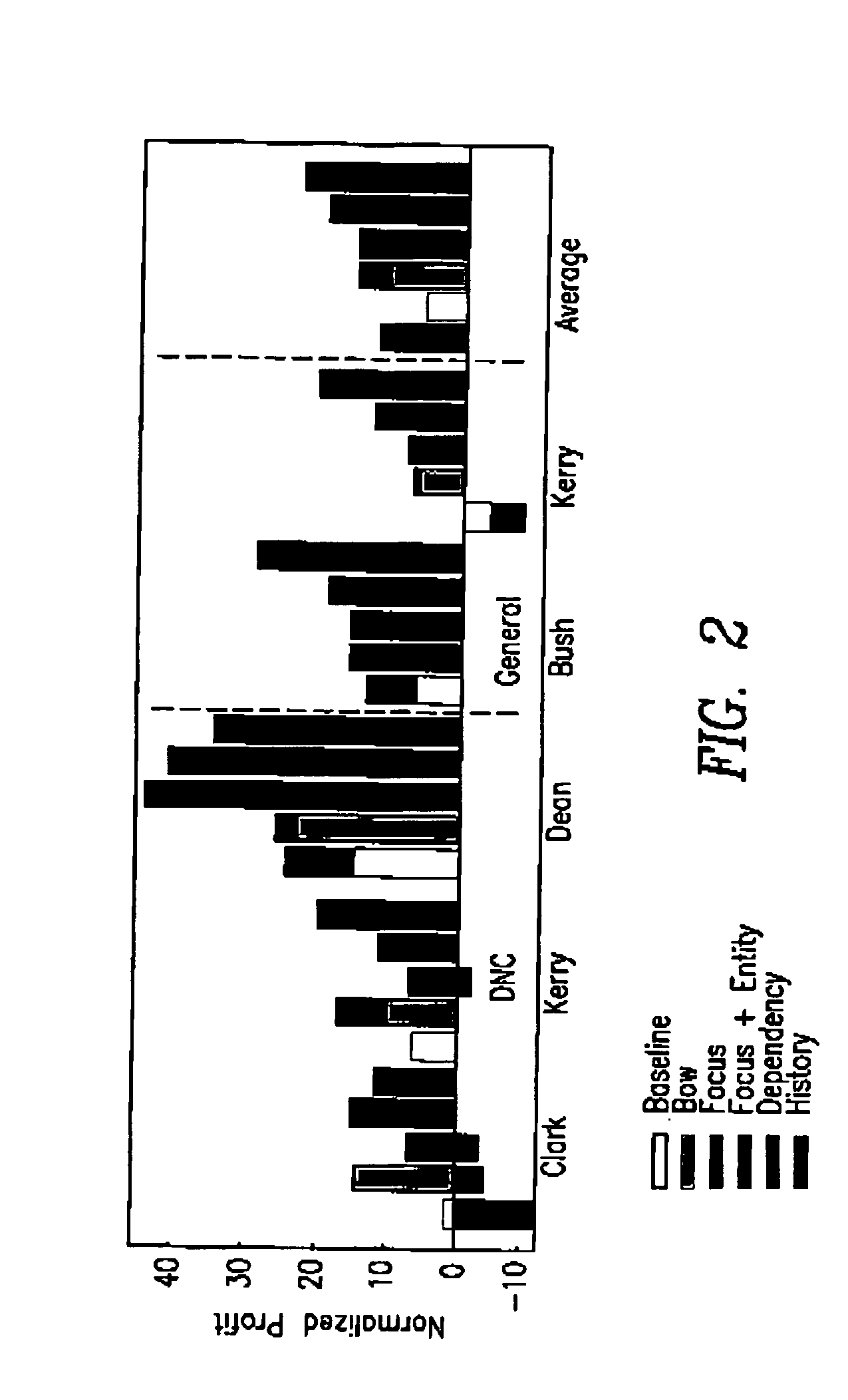

System and method for forecasting fluctuations in future data and particularly for forecasting security prices by news analysis

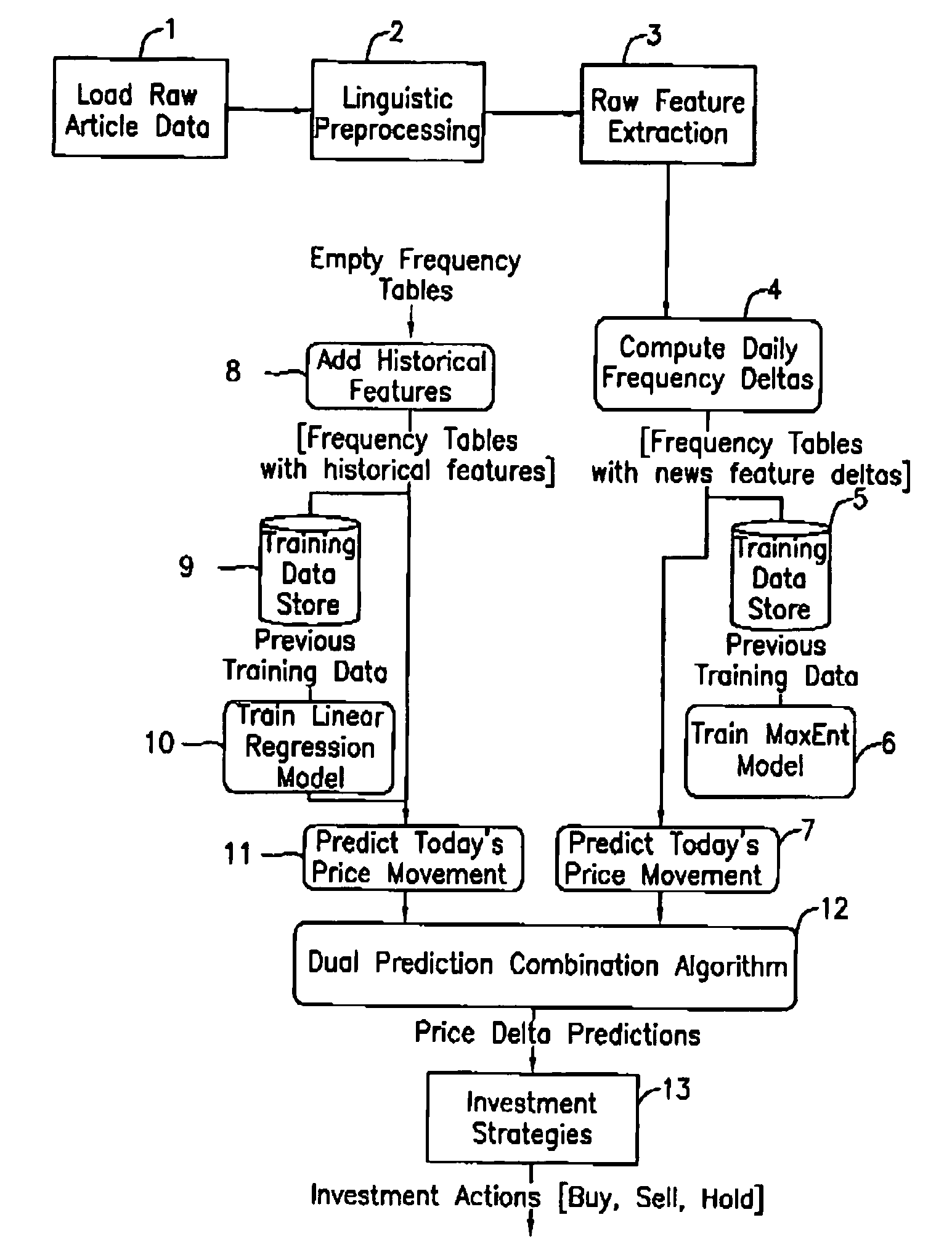

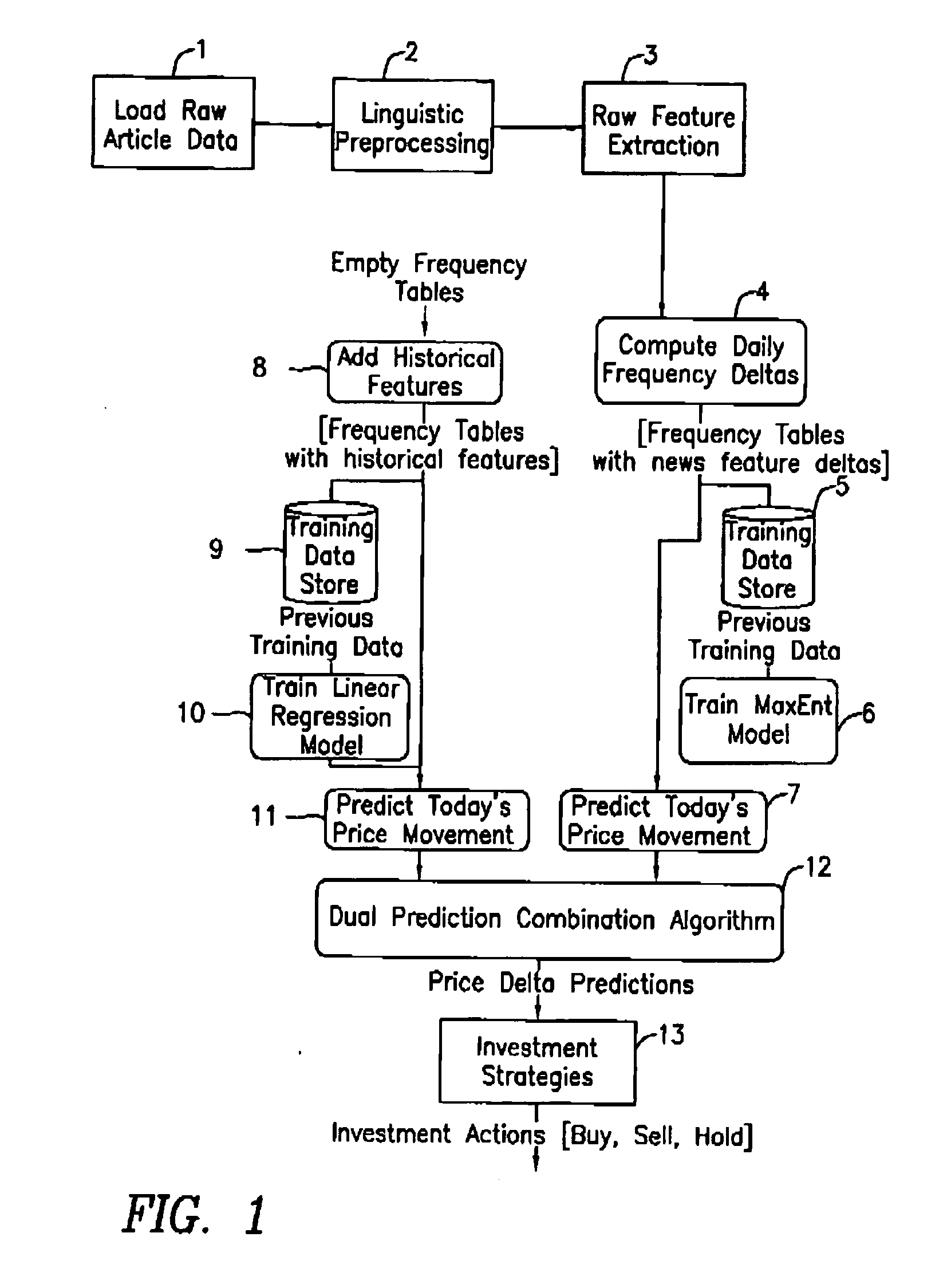

A system and method for predicting price fluctuations in financial markets. Our approach utilizes both market history and public news articles, published before the beginning of trading each day, to produce a set of recommended investment actions. We empirically show that these markets are surprisingly predictable, even by purely market-historical techniques. Furthermore, analyzing relevant news articles captures information features independent of the markets history, and combining the two methods significantly improves results. Capturing usable features from news articles requires some linguistic sophistication the standard naïve bag-f-words approach does not yield predictive features. Instead, we use part-of-speech tagging, dependency parsing and semantic role labeling to generate features that improve system accuracy. We evaluate our system on eight political prediction markets from 2004 and show that we can make effective investment decisions based on our systems predictions, whose profits greatly exceed those generated by a baseline system.

Owner:LERMAN KEVIN +1

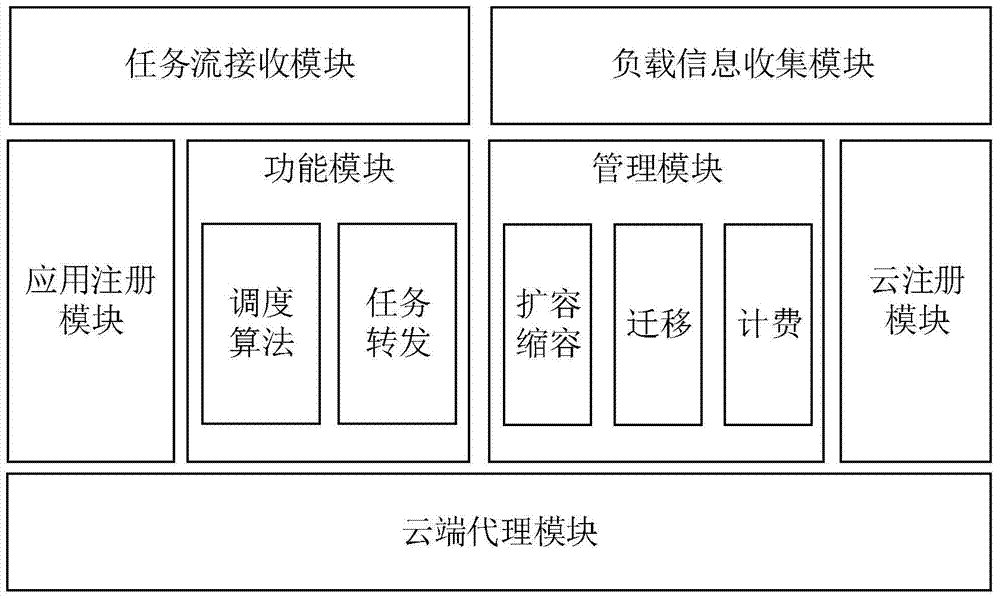

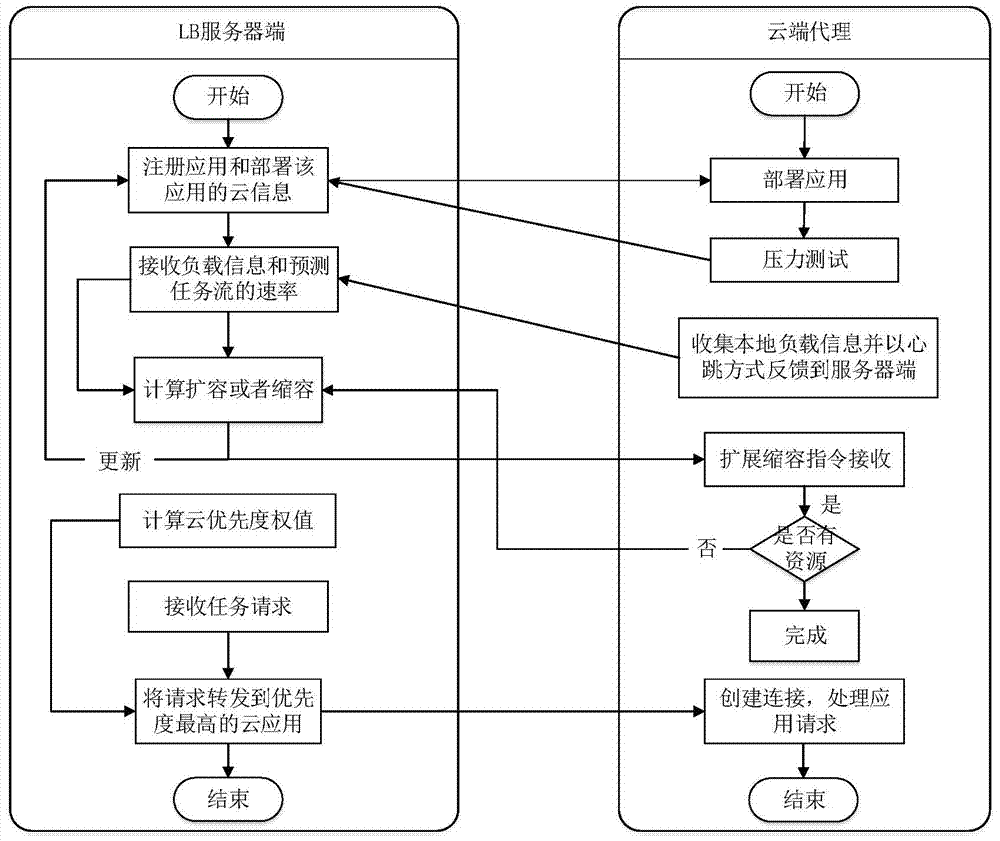

Load balancing method and system facing mixed cloud application

ActiveCN104850450AIncrease profitGuaranteed application effectResource allocationSoftware simulation/interpretation/emulationCloud resourcesOutbreak

The invention discloses a load balancing method and system facing mixed cloud application and a corresponding mixed cloud load balancing system. Aiming at the fact that a cloud tenant uses mixed clouds to calculate IaaS (infrastructure as a service) platform deployment application, the invention solves the problem of load balancing of the application under a multi-cloud environment. The system and method use a layered load balancing mechanism, load state information and resource state information of private clouds and public clouds are dynamically collected by a heartbeat packet at an upper layer, and issuing priorities of tasks to respective clouds are adjusted; at a lower layer, and LBaaS (load balancing as a service) internally provided form the clouds is used to perform load balancing among virtual machines. During outbreak of the cloud application, the public cloud with the highest cost performance can be selected for resource extension according to price fluctuation of the public clouds and the requirement of the cloud tenant on the minimal cost budget. According to the invention, the cloud tenant can be helped to customize application requirements per se when using the mixed clouds, and automatically select a cloud resource use scheme with the highest cost performance.

Owner:HUAZHONG UNIV OF SCI & TECH

Real-time price studies

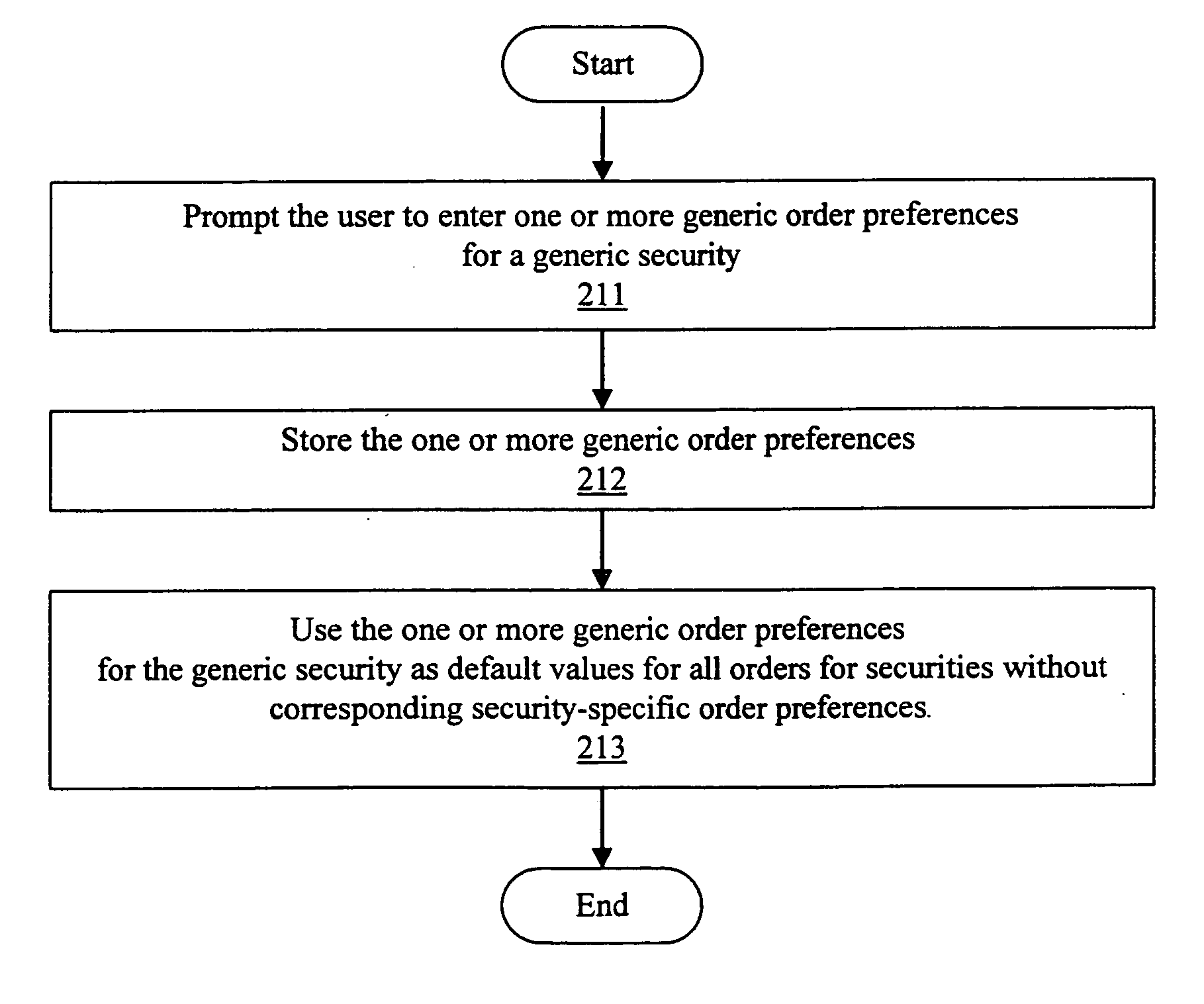

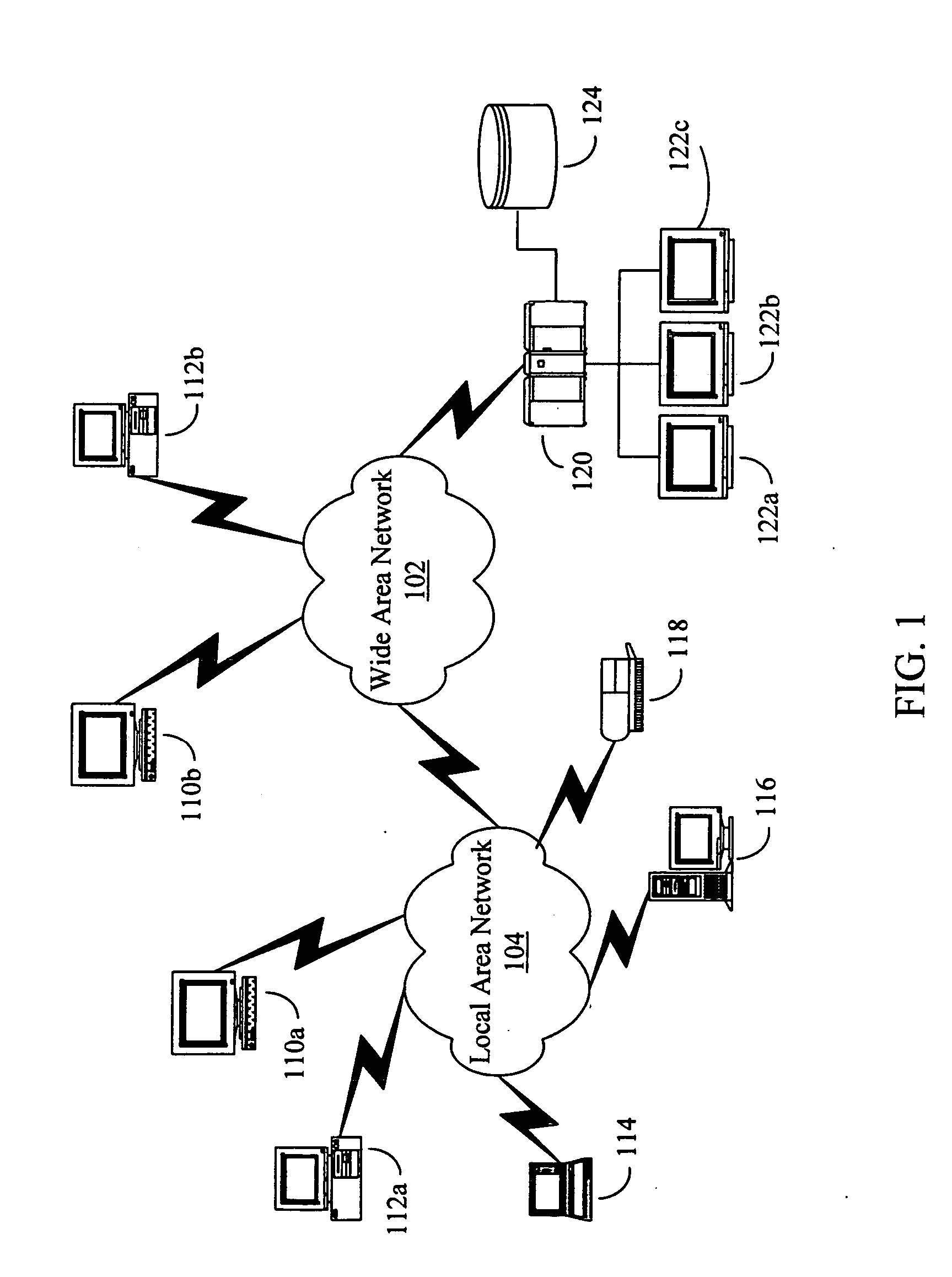

An improved method and system for computerized trading of securities in which order preferences for securities are entered by a user and are stored on a computer system for future use as default values in response to the user placing an order. The time that it takes to complete an order may be reduced through the use of previously selected order preferences being displayed to the user in the order placement window. In another method for order entry, a user may specify a price-point and a security transaction flag option for a security transaction (e.g., buy, sell, sell short, stop loss, stop limit, sell to open, sell to close, buy to open, buy to close) on a price chart window for a particular security. The computer system monitors the price fluctuation of the particular security, and takes the specified security transaction in response to the specified price-point being reached. In another embodiment, real-time results for user-selected studies are utilized as a tool for a user to decide on a price-point at which to take a particular security transaction on a particular security.

Owner:NESMITH KEVIN A +8

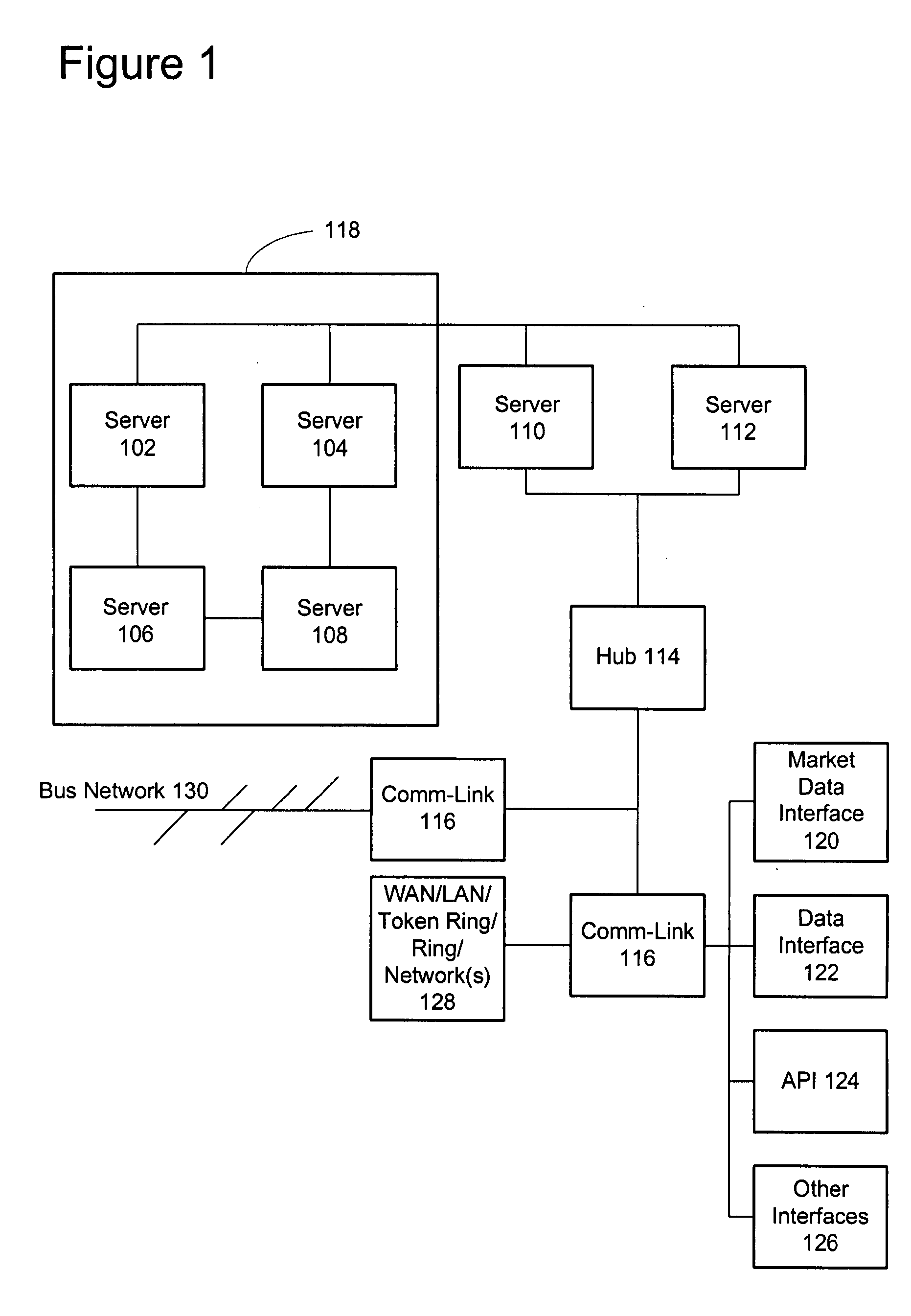

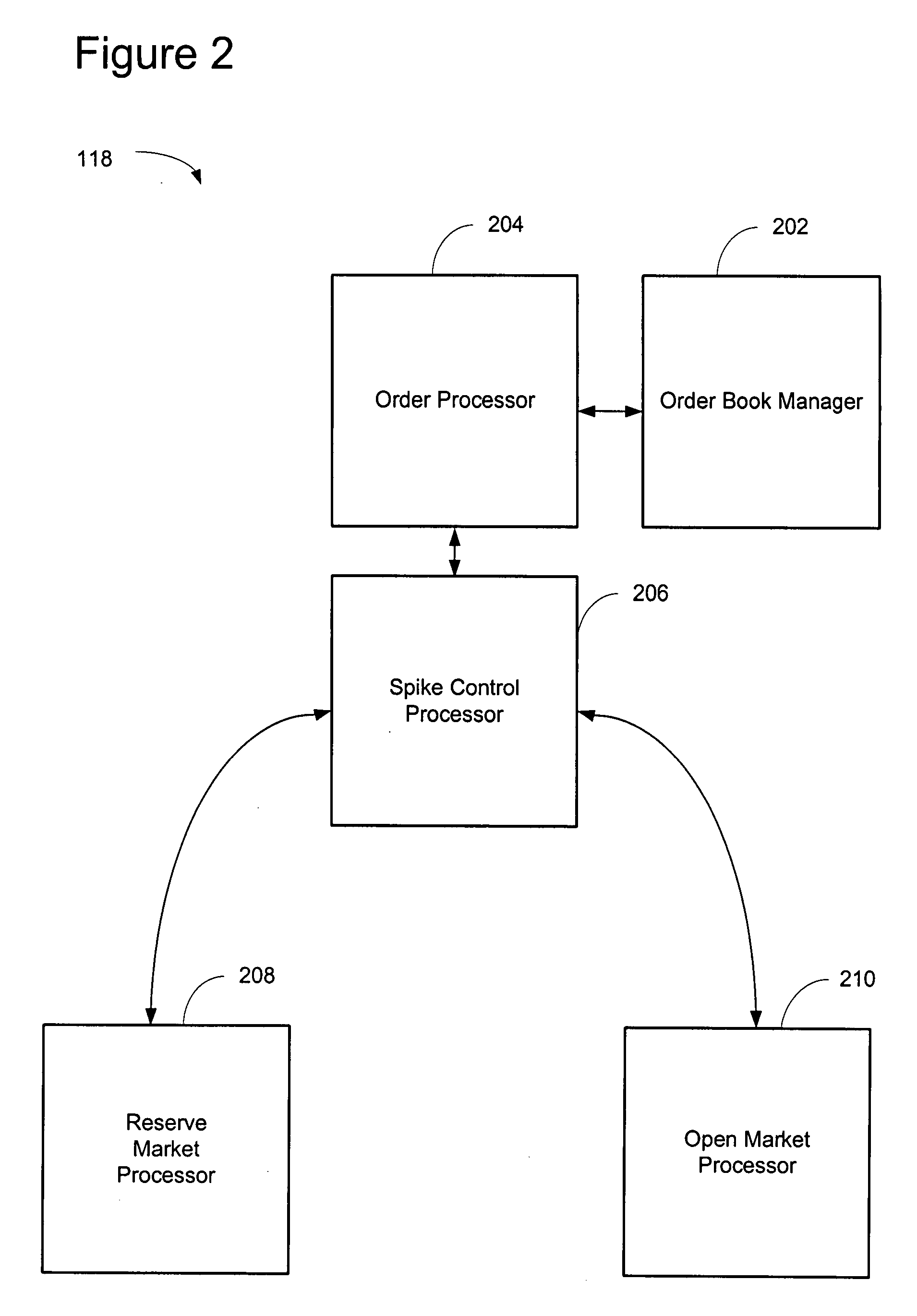

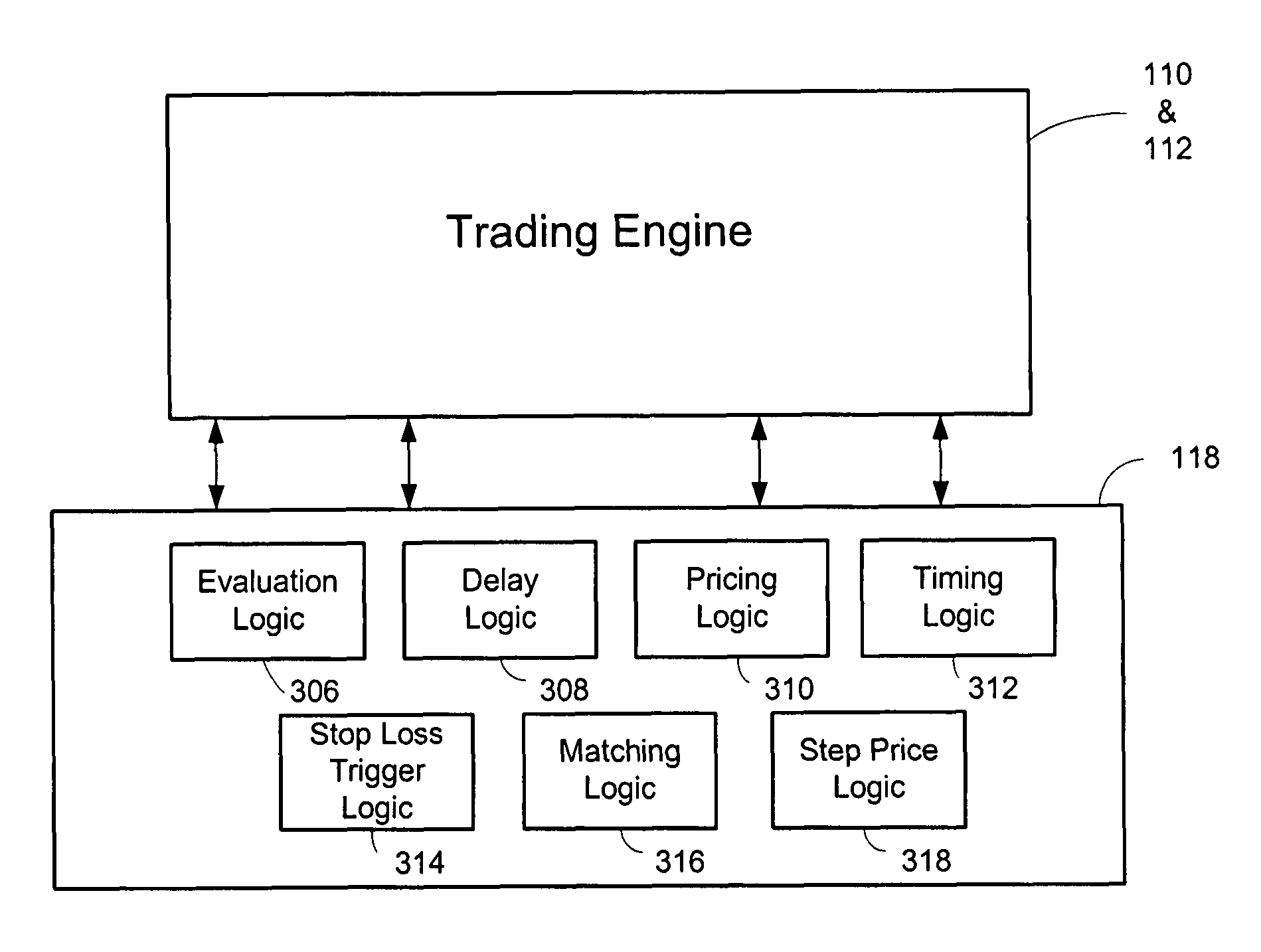

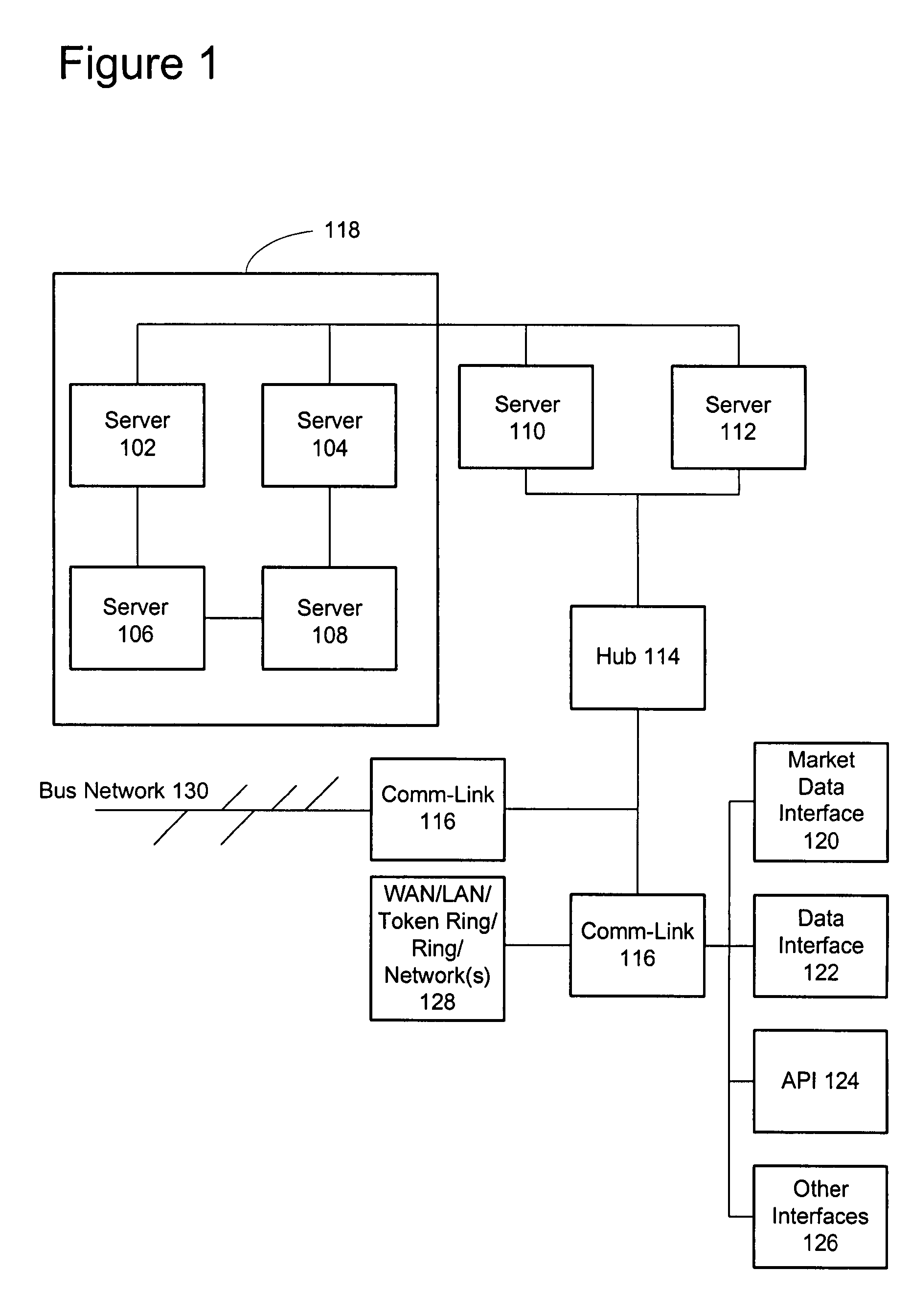

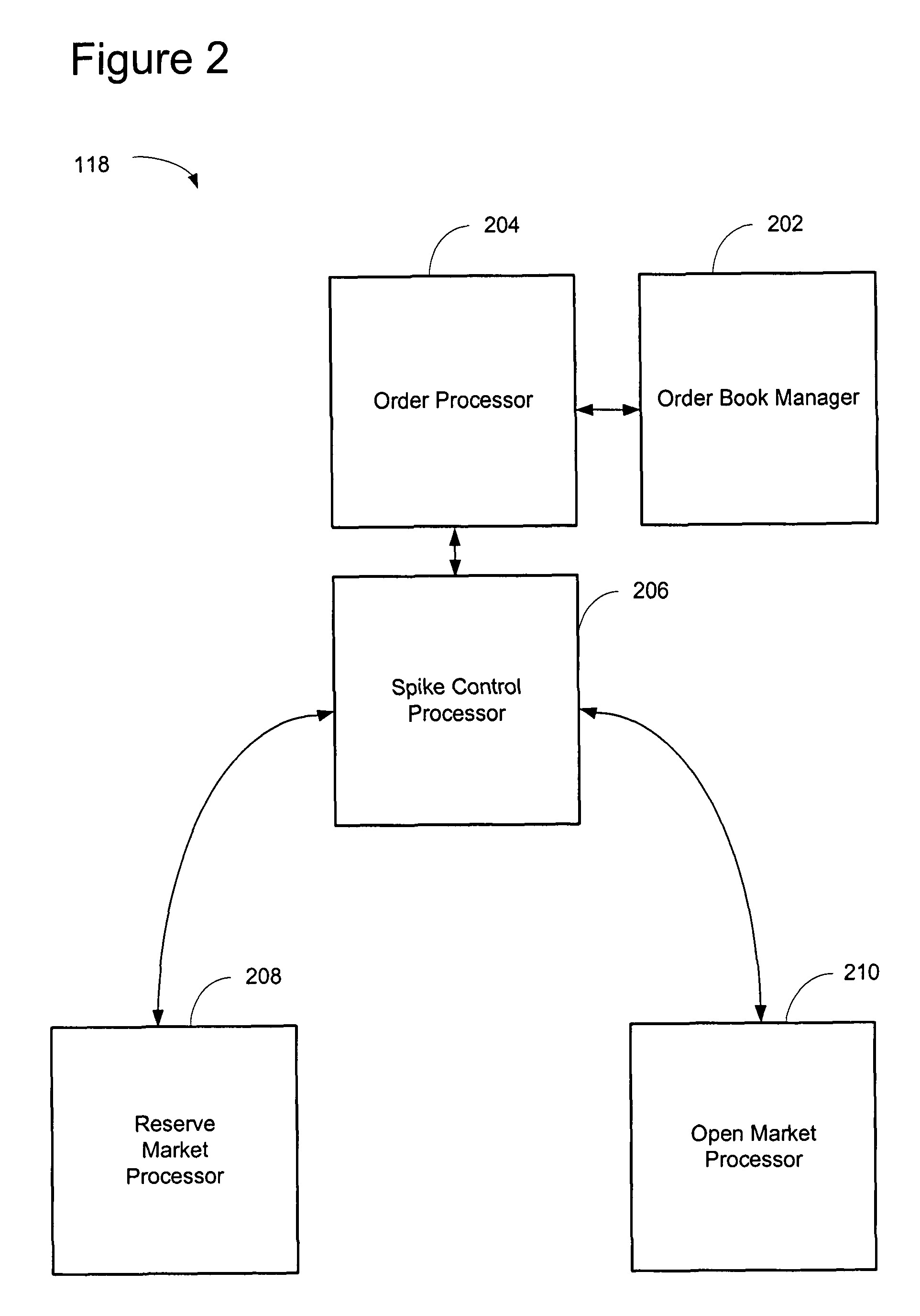

Controlling markets during a stop loss trigger

ActiveUS20080046356A1Reduce spikesFinanceComplex mathematical operationsSystem monitorPrice fluctuation

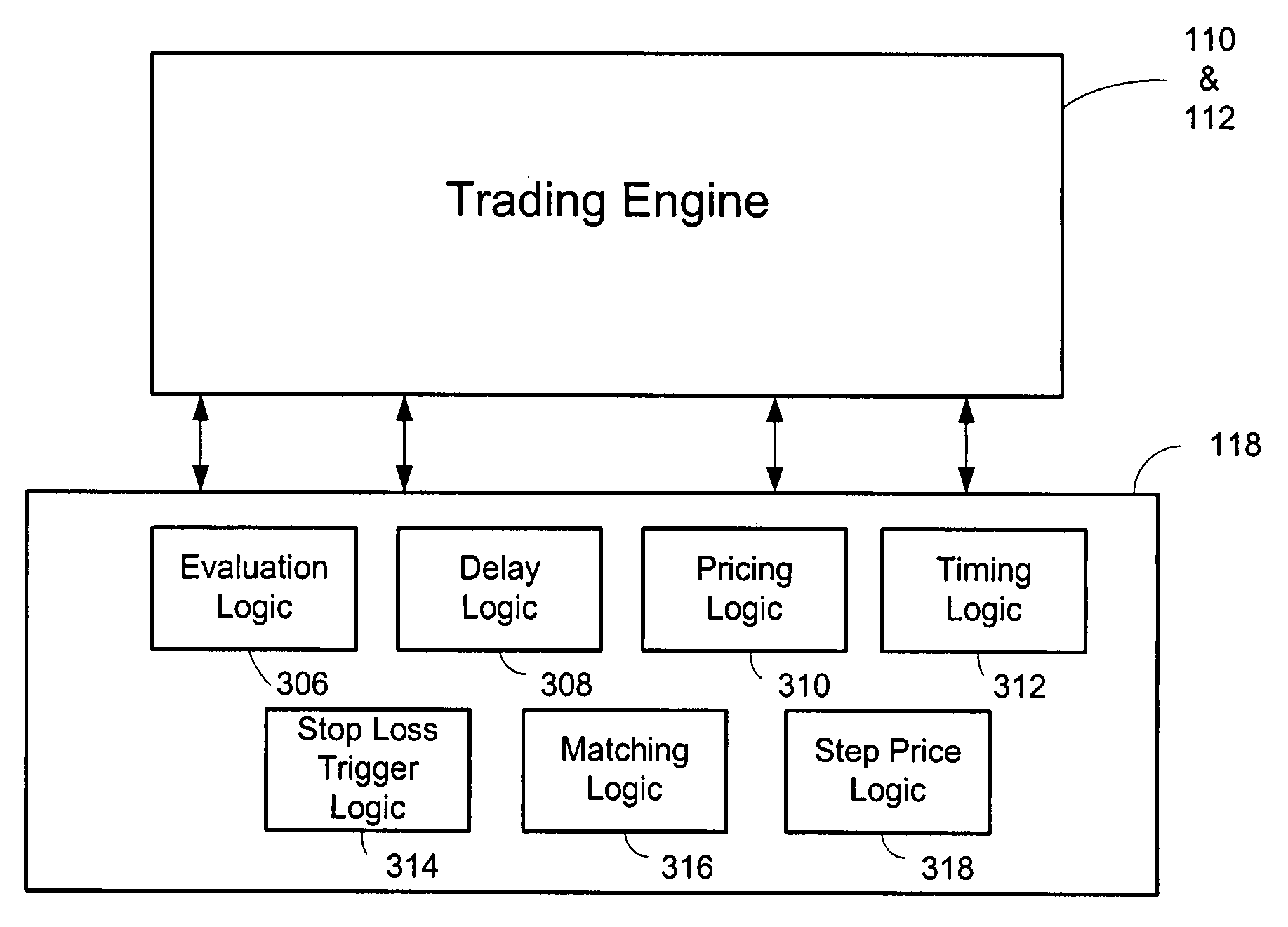

A system mitigates the effects of a market spike caused by the triggering and election of conditional orders in an automated matching system. The system monitors trading that takes place as a result of the cascading triggering of conditional orders. When an order is executed beyond a predetermined price threshold, an instrument may be flagged, allowing matching to take place only at or within the predetermined price threshold. Orders within the price threshold are matched at the price threshold against orders beyond the price threshold, in order to dampen any instantaneous damaging effects of the price spike. The system may adjust the price threshold when market appropriate, allowing the order flow to bring the market back to whatever is the true price level. The system mitigates price fluctuations that are purely conditional order cascade driven, but allows the market to continuously trade in controlled price and time intervals to ensure that a true market move can still occur and not have price control mechanisms hinder trade matching and true price discovery.

Owner:CHICAGO MERCANTILE EXCHANGE INC

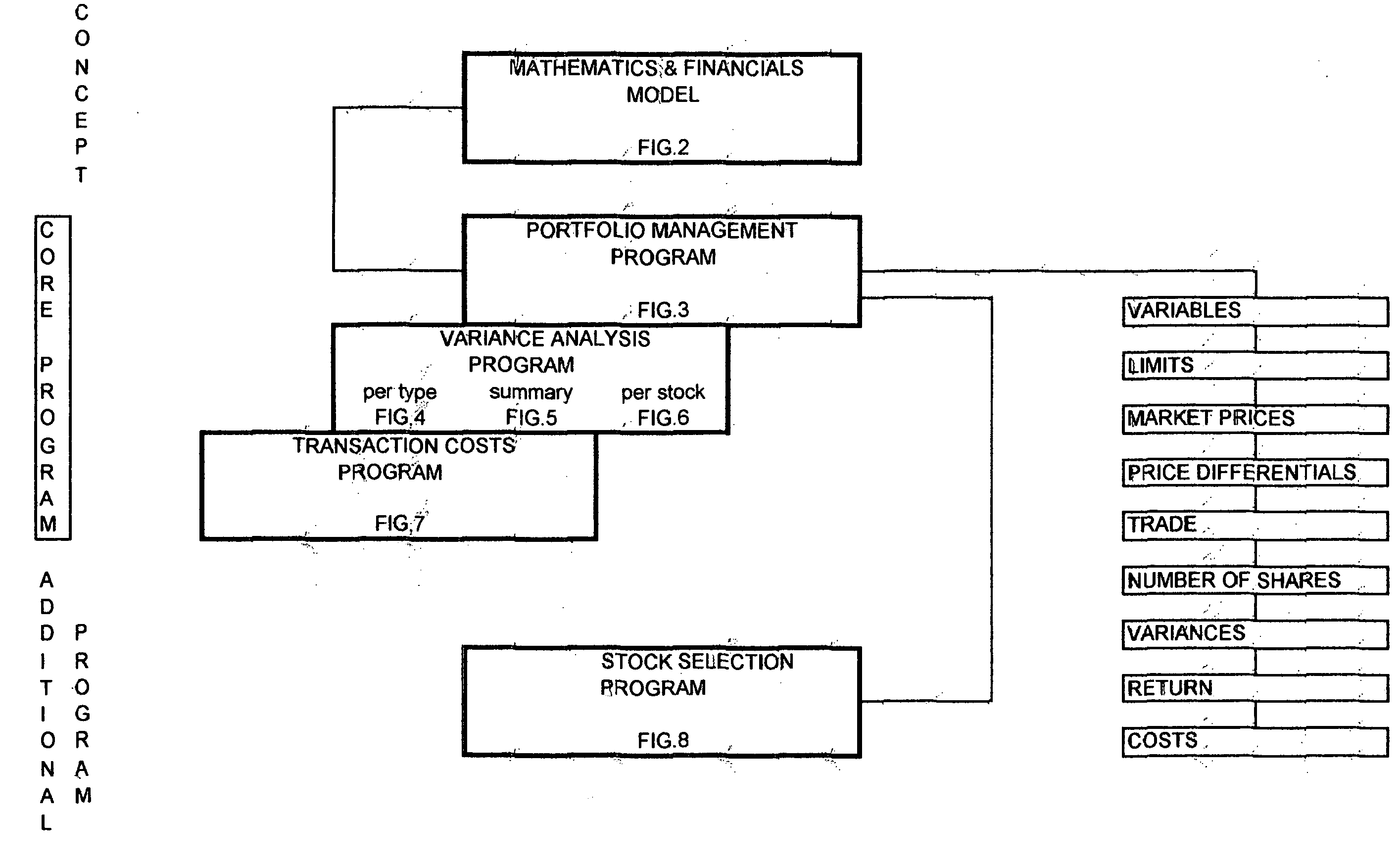

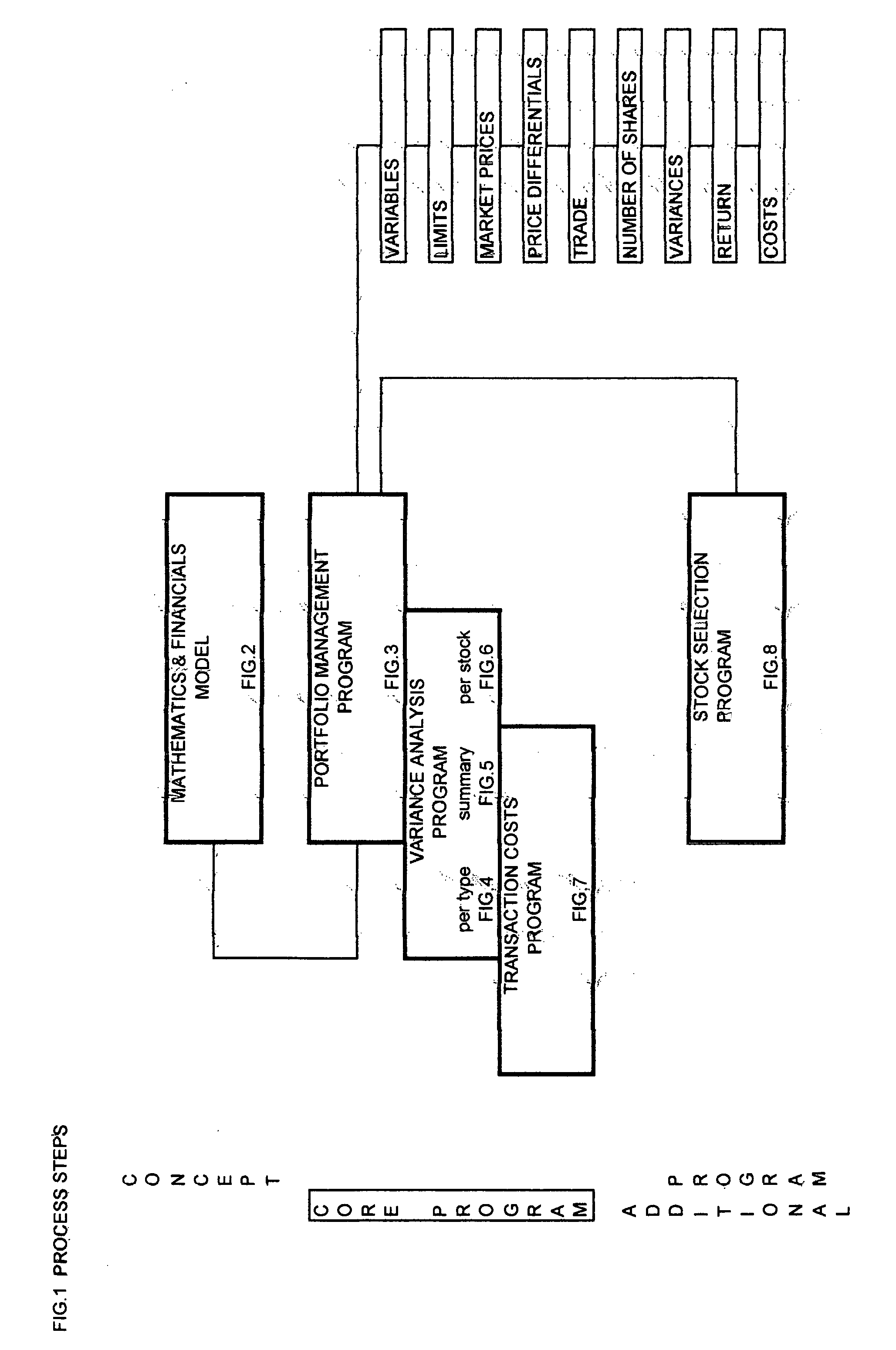

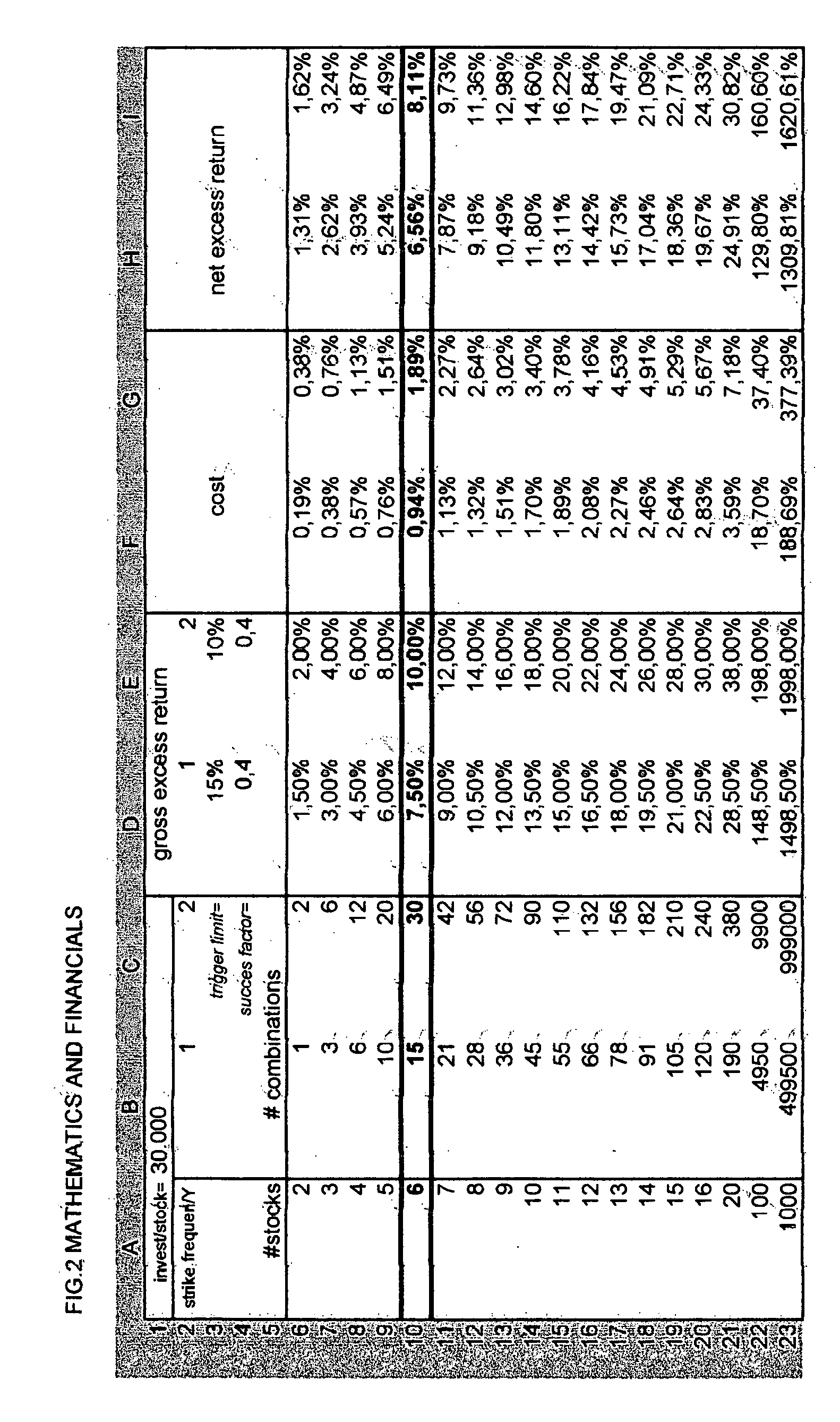

System for optimizing the return of an investment portfolio, using a method of multiple share combinations

InactiveUS20050149422A1Improve returnIncrease the number ofFinanceSpecial data processing applicationsElectronic formCombined method

Owner:VAN LIER EDOUARD

System for evaluating price risk of financial product or its financial derivative, dealing system and recorded medium

A system for correctly evaluating price distribution and risk distribution for a financial product or its derivatives introduces a probability density function generated with a Boltzmann model at a higher accuracy than the Gaussian distribution for a probability density. The system has an initial value setup unit and an evaluation condition setup unit. Initial values include at least one of price, price change rate, and price change direction of a financial product. The evaluation conditions include at least time steps and a number of trials. A Boltzmann model analysis unit receives the initial values and the evaluation conditions, and repeats simulations of price fluctuation, based on the Boltzmann model using a Monte Carlo method. A velocity / direction distribution setup unit supplies probability distributions of the price, price change rate, and price change direction for the financial product to the Boltzmann model analysis unit. A random number generator for a Monte Carlo method is employed in the analysis by the Boltzmann model, and an output unit displays the analysis result. A dealing system applies the financial Boltzmann model to option pricing, and reproduces the characteristics of Leptokurcity and Fat-tail by a linear Boltzmann equation to define risk-neutral and unique probability measures. Consequently, option prices can be evaluated in a risk-neutral and unique manner, taking into account Leptokurcity and Fat-tail of a price change distribution.

Owner:KK TOSHIBA

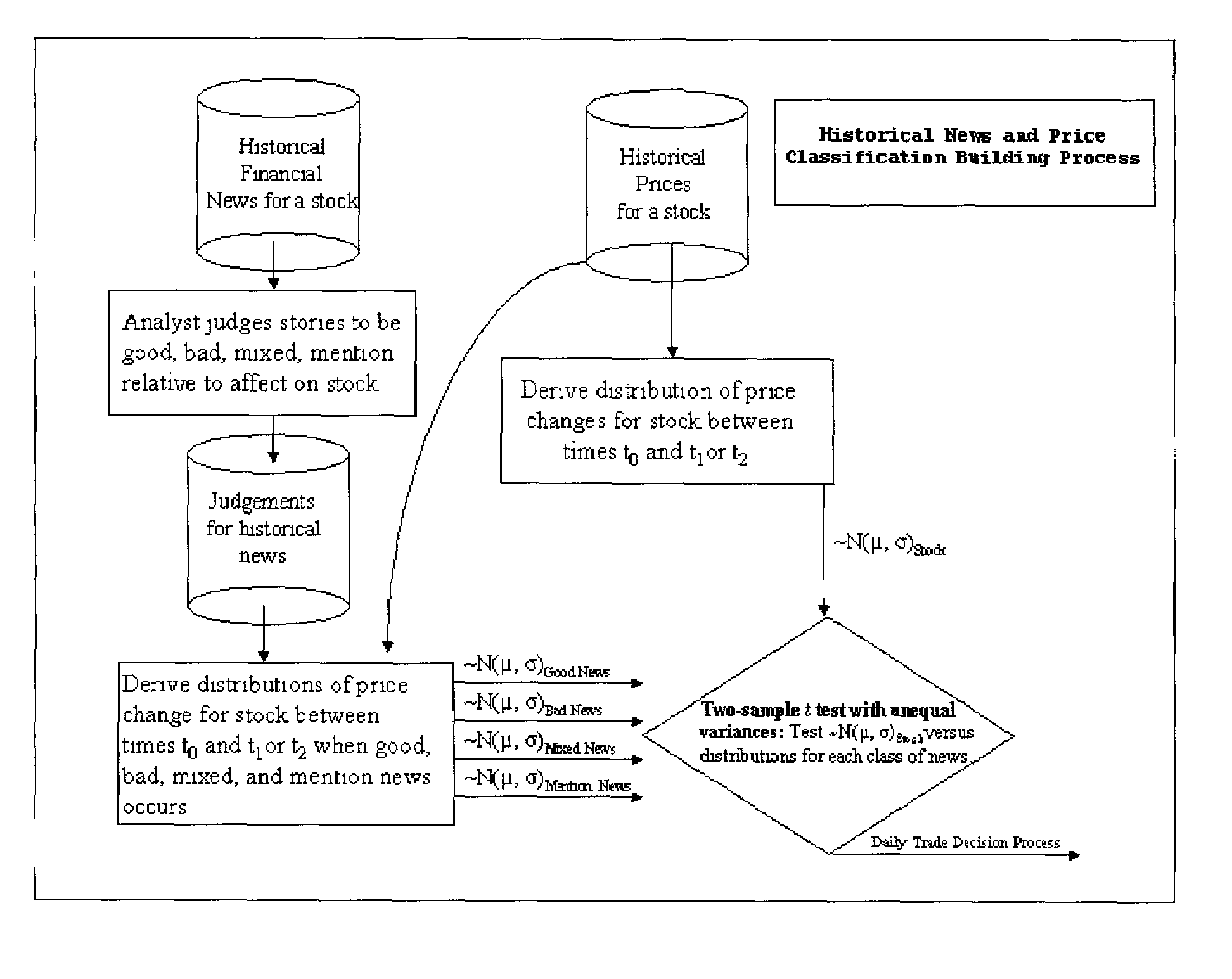

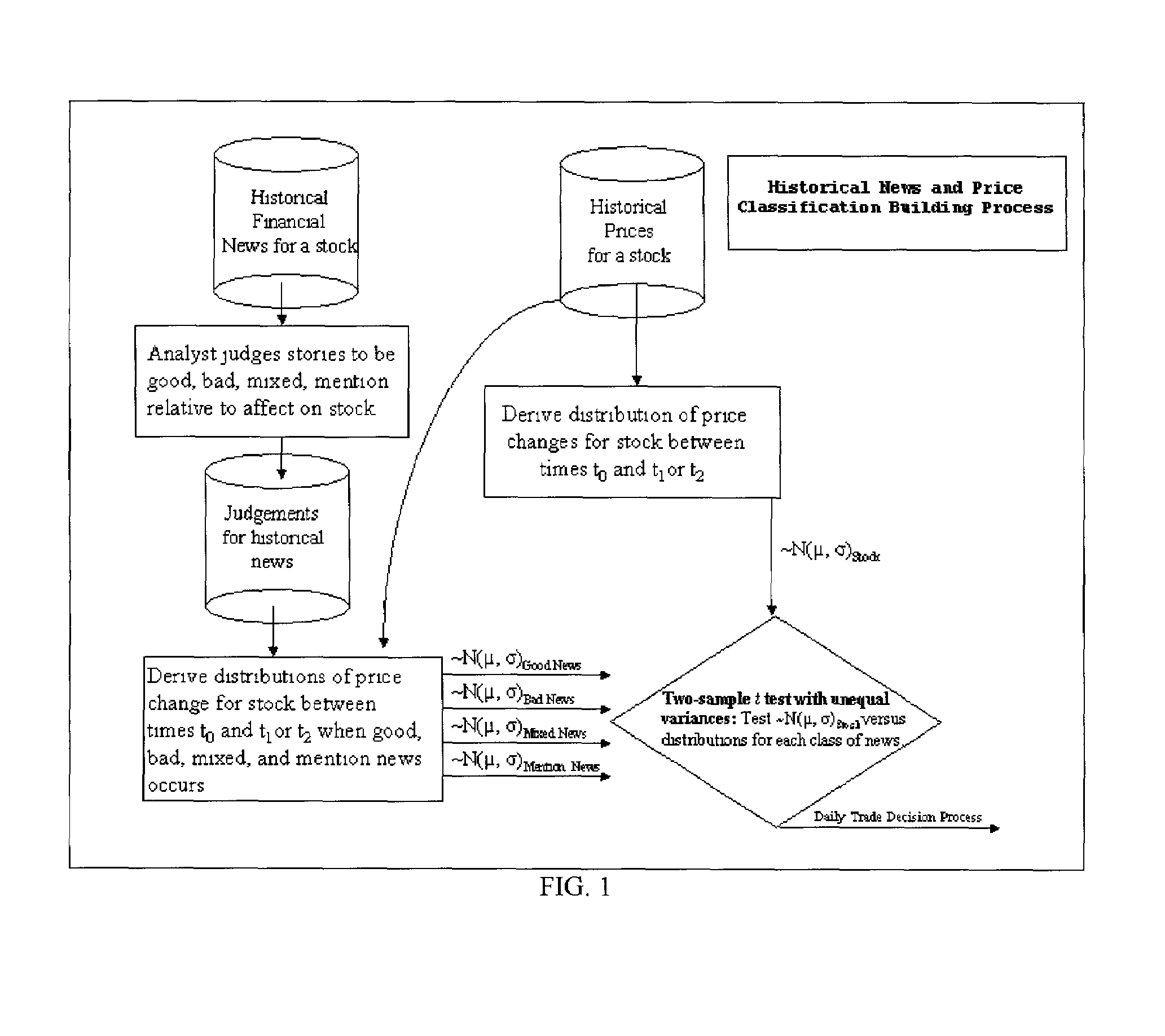

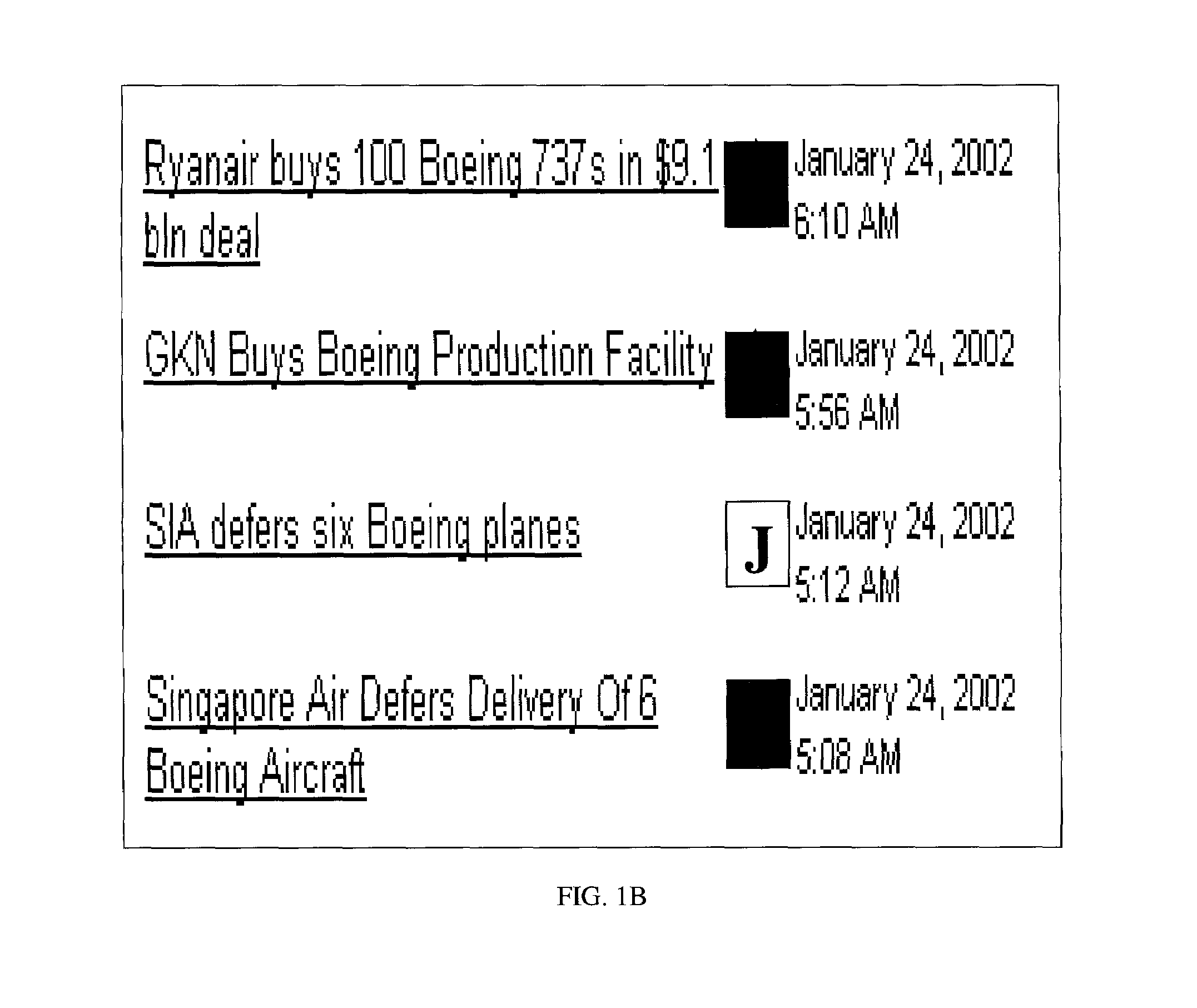

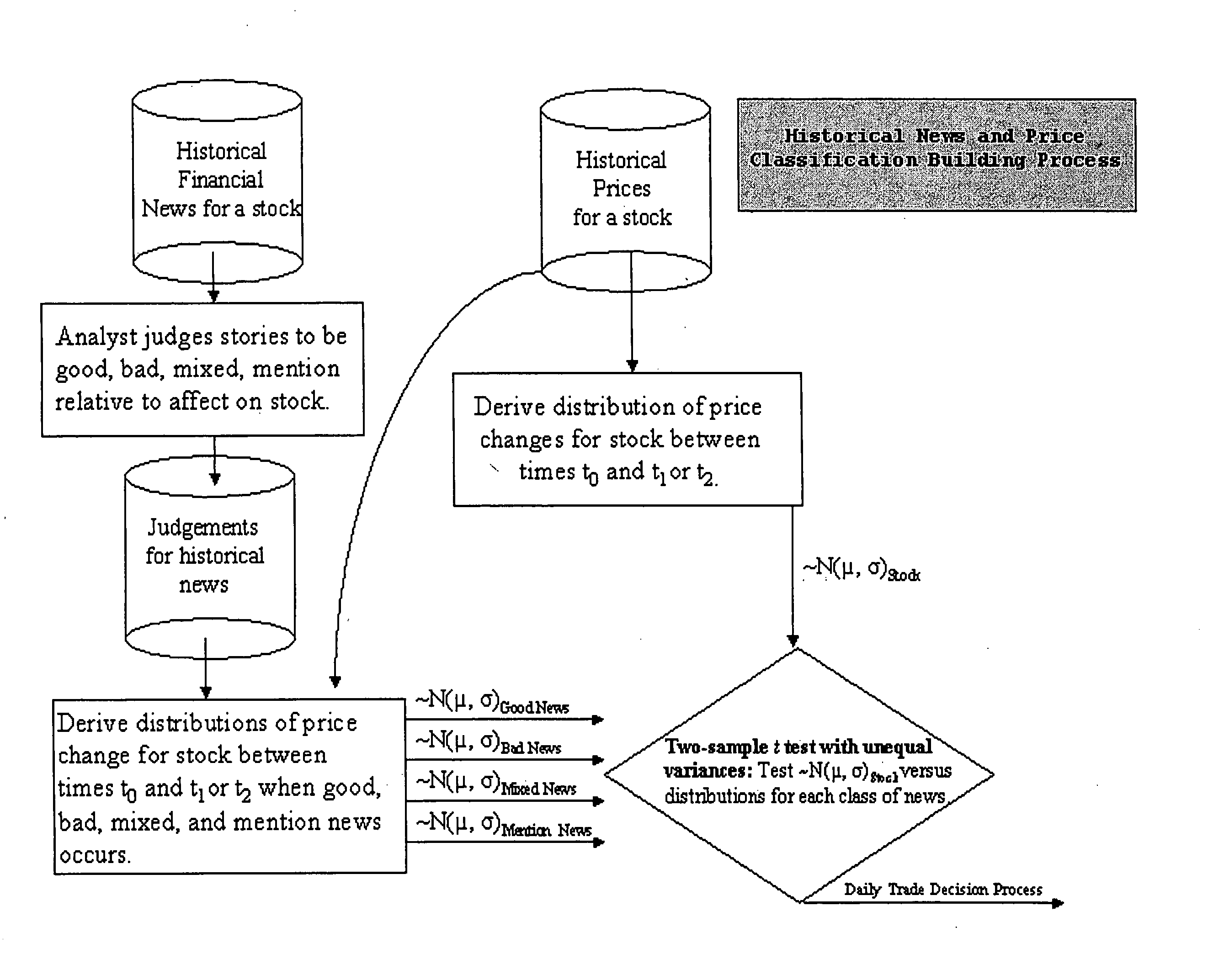

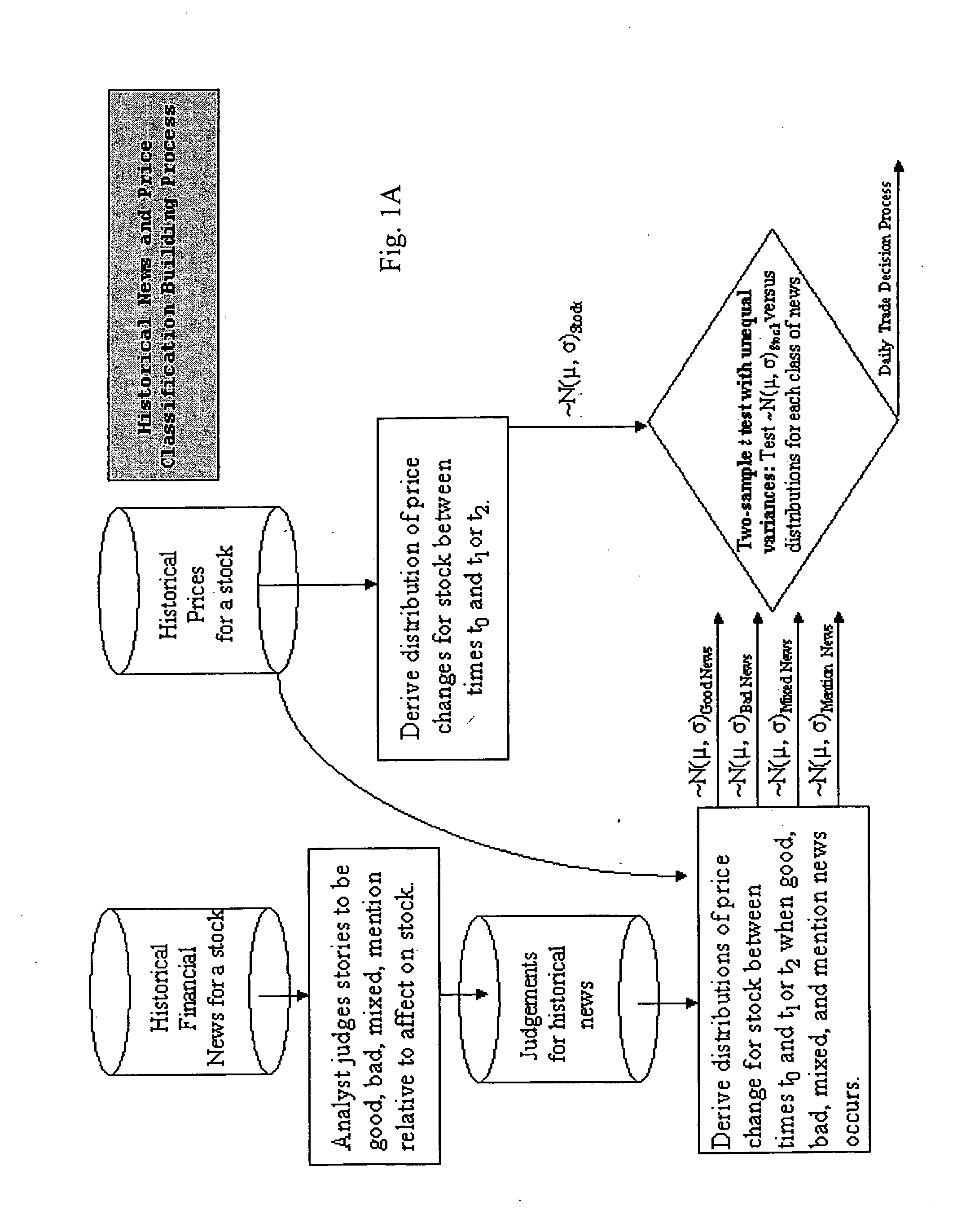

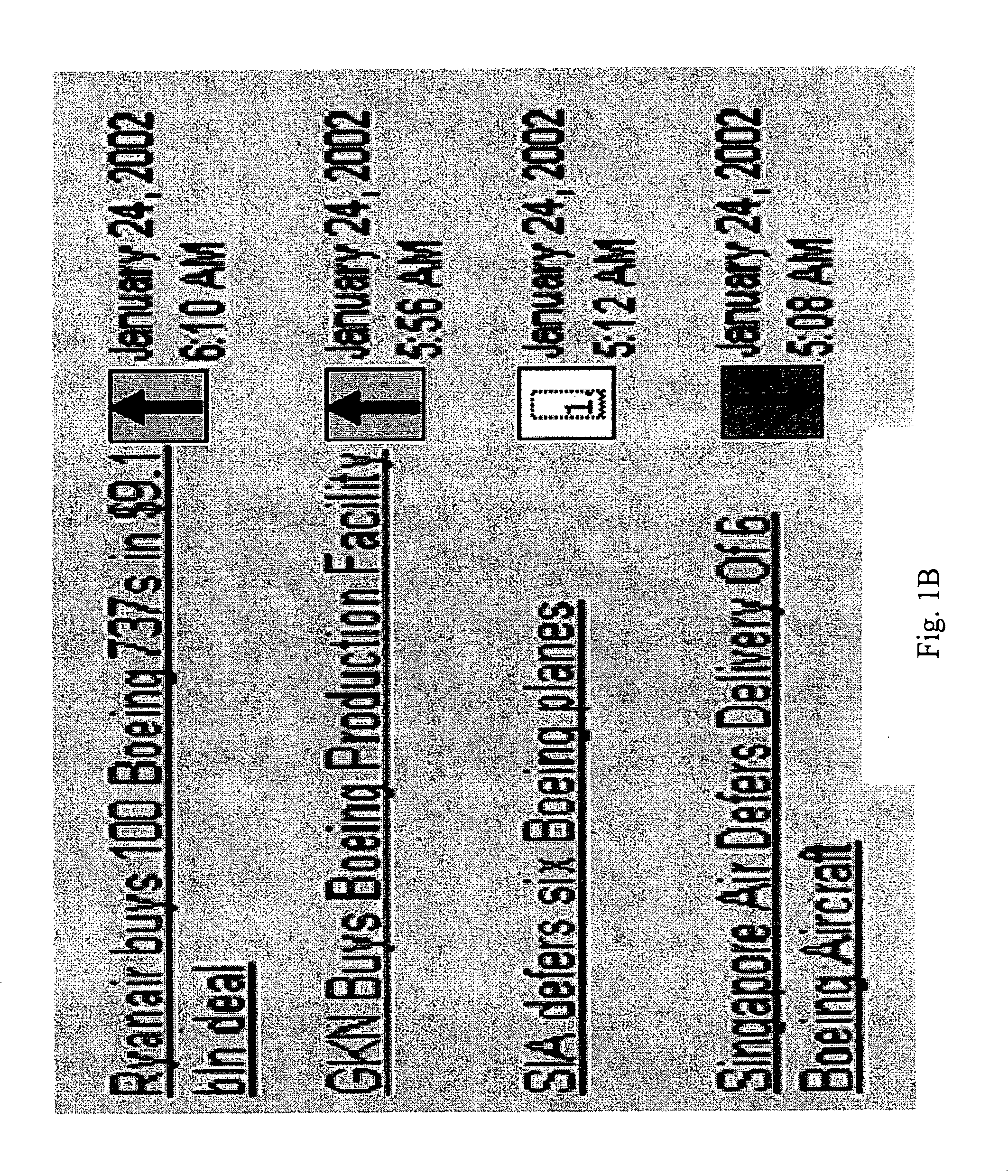

System and method for predicting security price movements using financial news

A method of creating a price prediction model that forecasts short-term price fluctuations in financial instruments by collecting, analyzing and classifying financial news for a financial instrument into categories. Distributions for the changes in price of the financial instrument for a set period of time and distributions for the changes in price of the financial instrument as a result of the financial news for each news category for a set period of time are then obtained. If the distributions for the changes in price of the financial instrument are statistically significantly different than the distributions for the changes in price of the financial instrument for a particular news category, and the mean for the change in price is greater or less than zero, a signal is produced indicating the trading action that should be taken for the financial instrument.

Owner:PAPKA RON

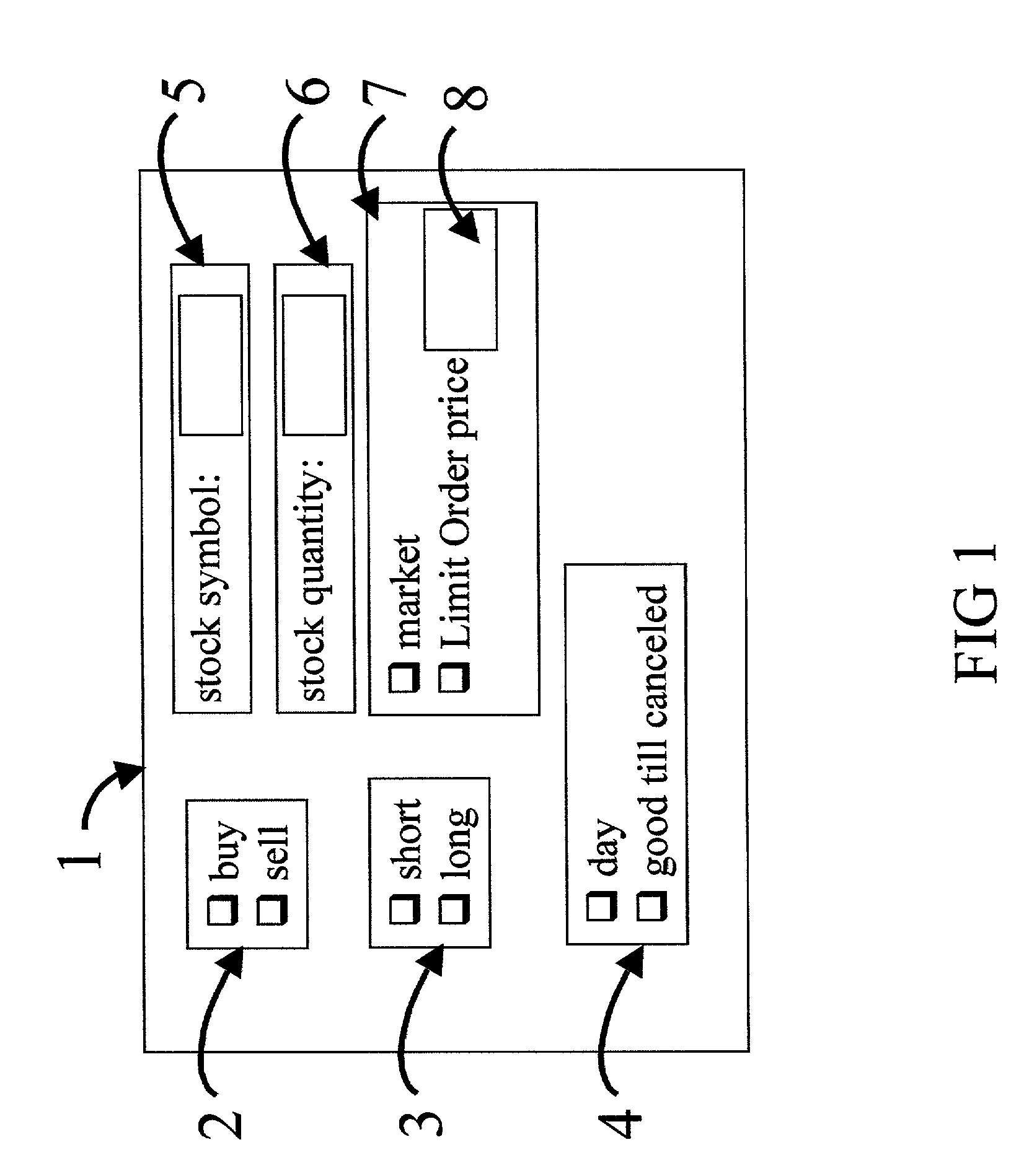

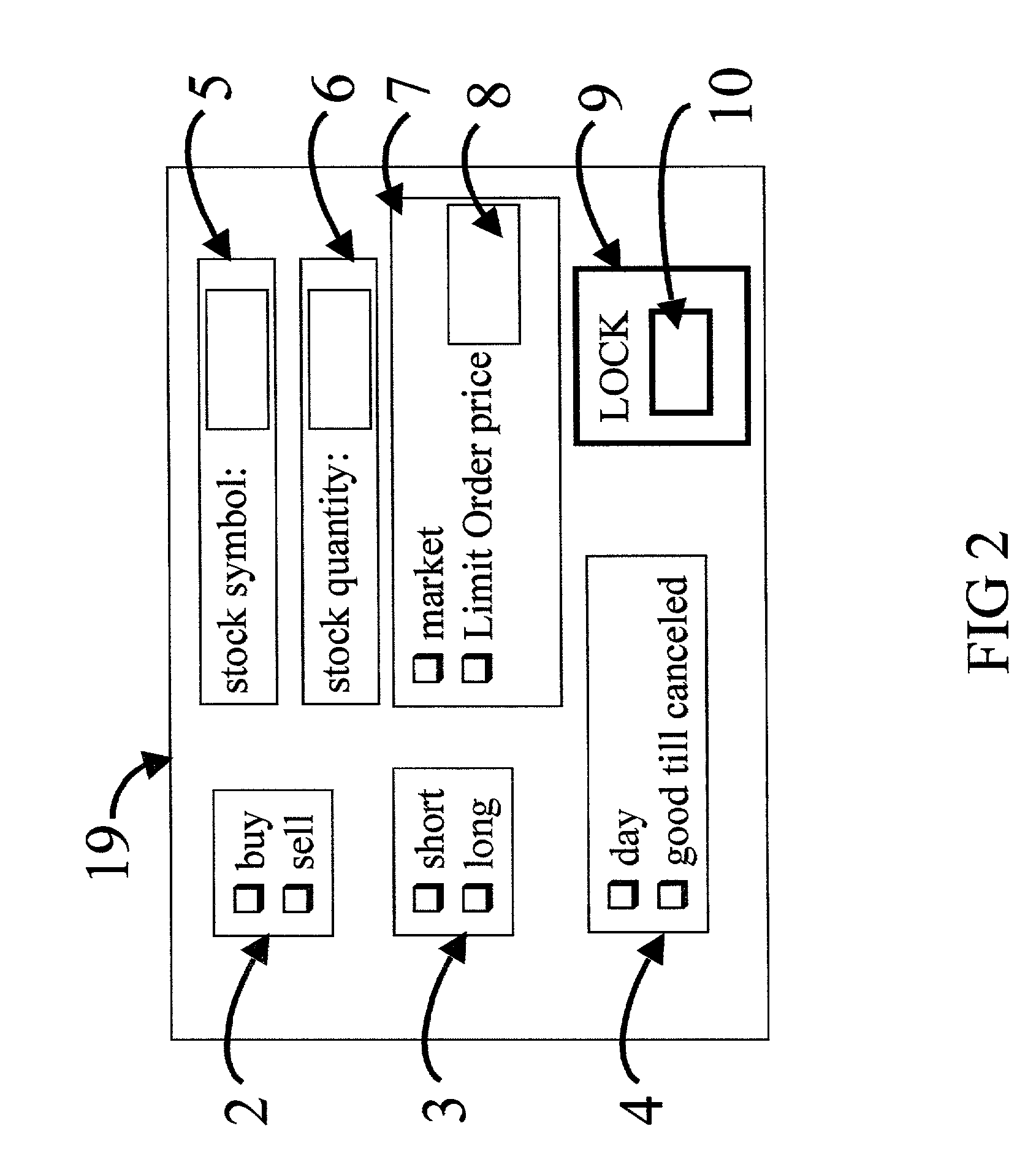

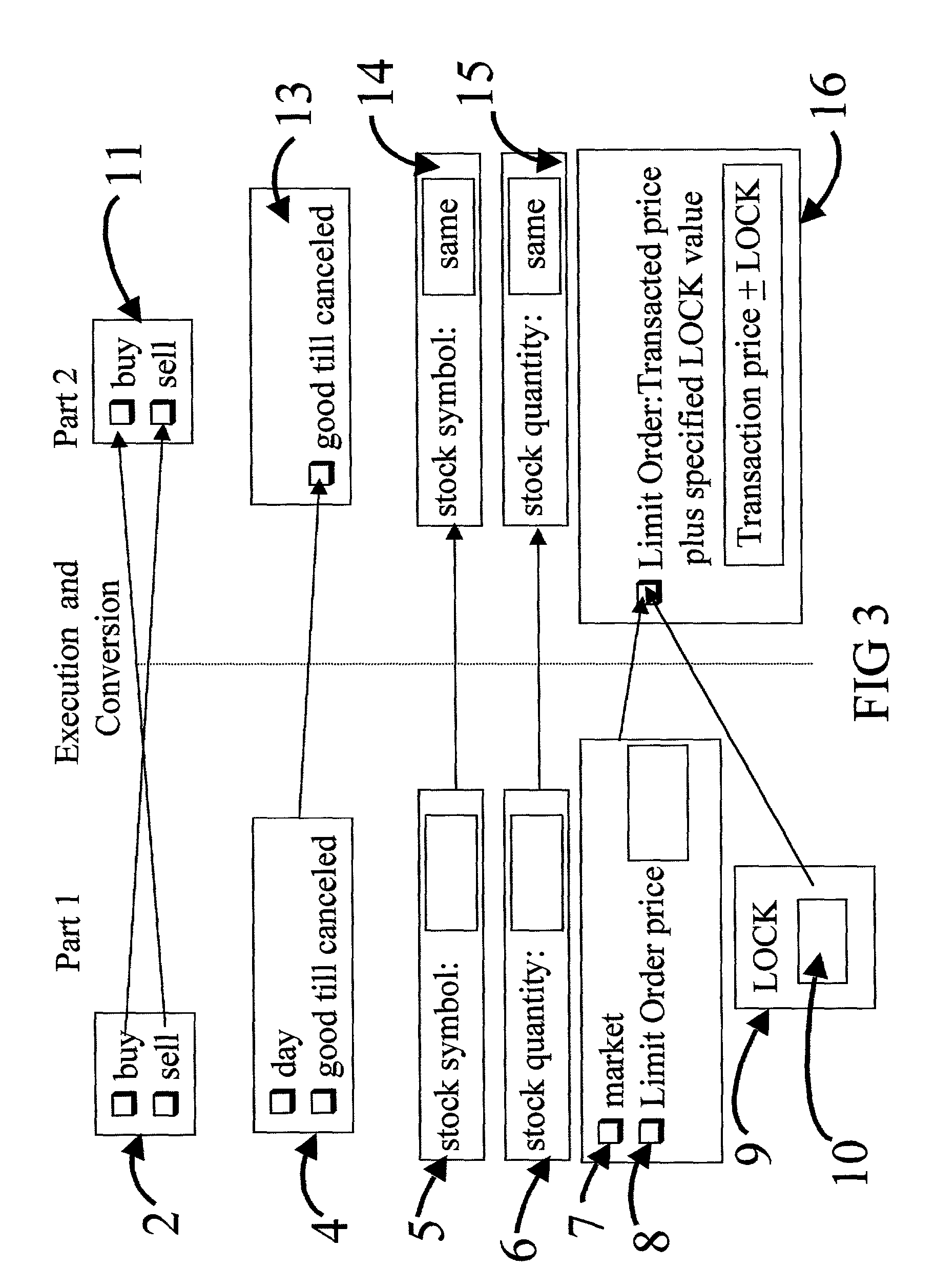

Stock trading limit order coupled link (Lock)

ActiveUS7386499B2Easy to implementBig advantageFinancePayment architectureEngineeringPrice fluctuation

This invention has the potential to generate very good return on investments from stocks that are conservative in movement. This invention will greatly benefit investors that do not have the time to constantly trade stock yet want to take advantage of normal price fluctuations. The Limit Order Coupled LinK (LOCK) invention, for example, will take a buy order, complete the transaction at the specified price, then automatically resubmits a new order to sell at a specified higher price. If specified, the process can automatically cycle through the buy-sell process a set number of time allowing the investor to take advantage of intra-day market moves and normal stock price fluctuations with no personal investor evolvement. The LOCK order, with set profit margins, allows on-line traders and brokers to place one order, which will automatically generate logical, sequenced additional orders returning a profit on each transaction. LOCK will benefit both the investor and the stock trading company.

Owner:KOCHER ROBERT

Controlling markets during a stop loss trigger

A system mitigates the effects of a market spike caused by the triggering and election of conditional orders in an automated matching system. The system monitors trading that takes place as a result of the cascading triggering of conditional orders. When an order is executed beyond a predetermined price threshold, an instrument may be flagged, allowing matching to take place only at or within the predetermined price threshold. Orders within the price threshold are matched at the price threshold against orders beyond the price threshold, in order to dampen any instantaneous damaging effects of the price spike. The system may adjust the price threshold when market appropriate, allowing the order flow to bring the market back to whatever is the true price level. The system mitigates price fluctuations that are purely conditional order cascade driven, but allows the market to continuously trade in controlled price and time intervals to ensure that a true market move can still occur and not have price control mechanisms hinder trade matching and true price discovery.

Owner:CHICAGO MERCANTILE EXCHANGE INC

Power grid construction new project cost rapid estimation method based on fuzzy mathematics

InactiveCN106600464AQuick searchForecast cost trendsData processing applicationsEstimation methodsPower grid

The invention provides a power grid construction new project cost rapid estimation method based on fuzzy mathematics. The method comprises a step of establishing a database to realize the query of historical data for the huge cost data of a power grid project construction object, a step of carrying out accurate investment calculation on a power grid project with an investment need based on historical cost data mining and general cost application, a step of analyzing and monitoring a price fluctuation main reason by using a mathematical modeling method, and establishing a prediction model, and a step of establishing a cost early warning mechanism in an investment decision-making stage with the combination of the cost control line. Through the implementation of the method, the rapid query of historical project investment can be realized, the accurate investment calculation of the power grid project with an investment need is carried out, the working is effectively and accurately developed, and the scientific decision-making of investment is supported.

Owner:重庆电力设计院有限责任公司

Method and system for monitoring abnormal fluctuation risk of agricultural product market

InactiveCN107798482ARealize monitoringHigh forward-lookingResourcesMarket data gatheringCvd riskPrice fluctuation

The invention discloses a method and system for monitoring an abnormal fluctuation risk of an agricultural product market. The method comprises the steps: obtaining historical agricultural product data of a monitoring early-warning object; analyzing a price fluctuation rule through combining with the historical agricultural product data; carrying out the fitting of the price fluctuation distribution mode according to the historical agricultural product data and the price fluctuation rule; determining an early-warning threshold value of the market abnormal fluctuation through combining with thedistribution mode; obtaining the real-time agricultural product data of the monitoring early-warning object; calculating a price change amplitude of the monitoring early-warning object according to the distribution through combining with the real-time agricultural product data; judging whether the price change amplitude exceeds the early-warning threshold value or not: issuing the early-warning information if the price change amplitude exceeds the early-warning threshold value. The method or system provided by the invention achieves the monitoring and early warning of the market price of an agricultural product.

Owner:AGRI INFORMATION INST OF CAS

Quick dissolution method for high-purity rhodium material

The invention discloses a method for quickly dissolving a high-purity rhodium material. A precious metal insoluble rhodium material is mixed with an acid liquid and an oxidant according to a certain proportion and then placed into a customized pressure container, the temperature is controlled to between 160 and 300 DEG C, the oxygen partial pressure is between 0 and 3.0MPa, the reaction time is between 1 and 8 hours, the precious metal rhodium material is quickly dissolved under high temperature and high pressure to produce an acid rhodium solution, the dissolution ratio is more than 98 percent, and the yield is more than 99 percent. The method has the advantages of short flow, short production period, high dissolution efficiency, environmental protection, high yield, low cost, energy conservation and so on, has important popularization value in precious metal industry refining and compound production fields, can reduce the dispersion of precious metal, shorten production period, reduce capital overstocking, and reduce the risk caused by the price fluctuation of the precious metal.

Owner:KUNMING INST OF PRECIOUS METALS

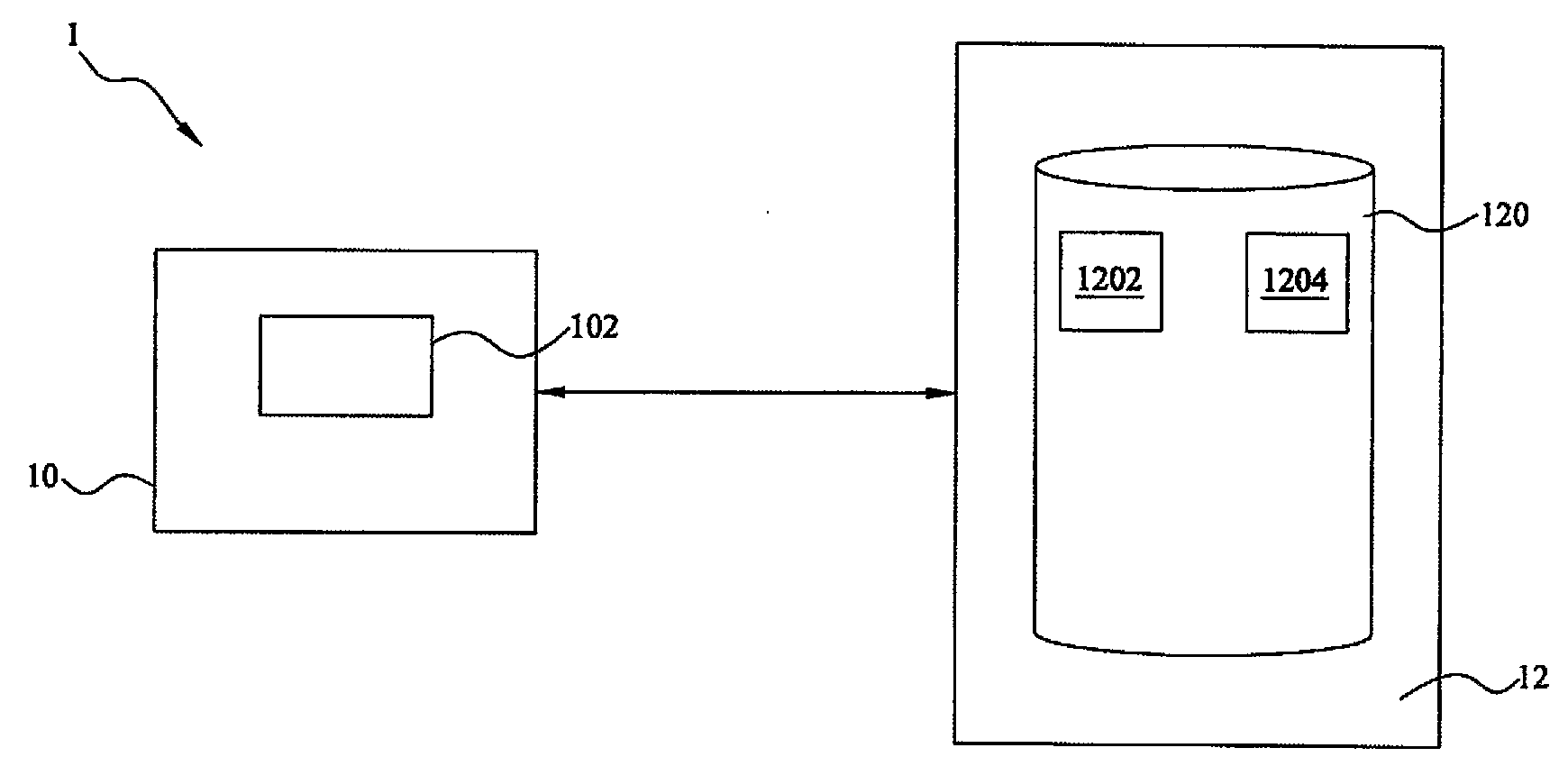

Adapter device and method for charging a vehicle

InactiveCN102089178ASimple Data CouplingSave on plug connectionsBatteries circuit arrangementsVehicular energy storageCharge controlHabit

The invention relates to an adapter device (10) and a method for charging a vehicle (20), having an interface (11) for detecting internal vehicle operation data (30) containing factors which report driving habits according to lifestyle, and an interface (12) for detecting details related to the fluctuation of energy prices (31), having a device (13) for detecting and planning requirements, said device (13) being designed for deducing an energy requirement profile (40) using the vehicle operation data (30) and for producing a future requirement plan based on at least one of the named factors, said device (13) further being suitable for deducing the duration and frequency of vehicle down times (41, 41') by incorporating the requirement plan, having a charging optimizing device (14) which isdesigned for comparing the vehicle down times (41, 41') with the energy price fluctuation (31) details and for producing a vehicle charging plan (42) which is optimized for time and / or price and is based on the results of the comparison, and having a charging control unit (15) which is designed for charging the vehicle (20) from an energy storage (21) in a manner controlled by the charging plan.

Owner:SIEMENS AG

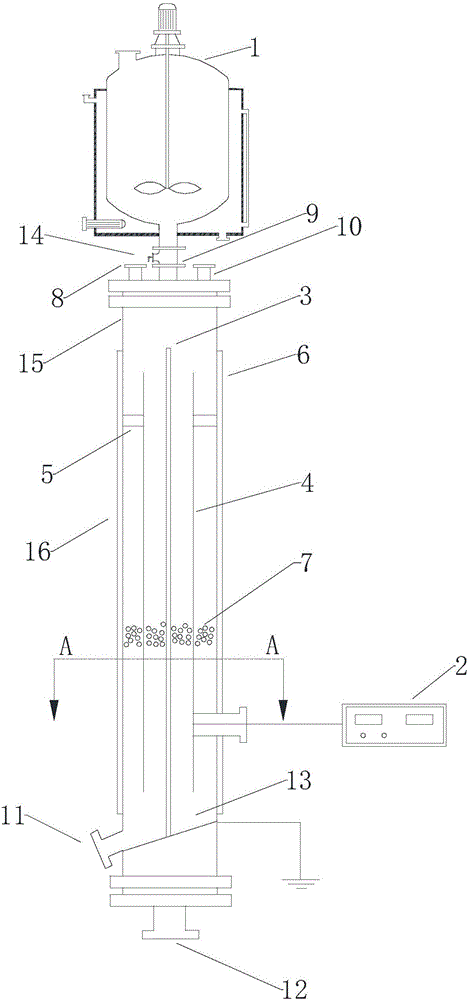

Marine fuel oil and production process and device thereof

InactiveCN106753611AImprove removal efficiencyIncrease the amount of participationLiquid carbonaceous fuelsEnergy based chemical/physical/physico-chemical processesSlurryMarine fuel

The invention discloses marine fuel oil and a production process and device thereof. The marine fuel oil and the production process and device thereof have the advantages that the marine fuel oil is produced by blending FCC slurry, coal tar, catalytic diesel oil, methanol, ethanol, shale oil, vacuum residue and auxiliaries according to a certain proportion, the main indexes of the blended oil meet the quality requirements on 180# marine fuel oil in national standards (GB 17411-2015), the production is performed by using cheap raw materials which are easy to obtain, raw material cost is lowered to the maximum extent, multiple components of the marine fuel oil can replace one another and can be flexibly selected according to market quotations, and the adverse effect caused by raw material price fluctuation can be relieved; the blended oil is purified by a static separation manner, fine solid catalyst particles can be removed, a static separation device is improved, a traditional double-electrode separation manner is abandoned, static separation efficiency is increased effectively, the adding quantity of the relatively-cheap FCC slurry is increased, and raw material cost is reduced; by a three-electrode design, the utilization rate of device internal space is increased.

Owner:OCEAN UNIV OF CHINA

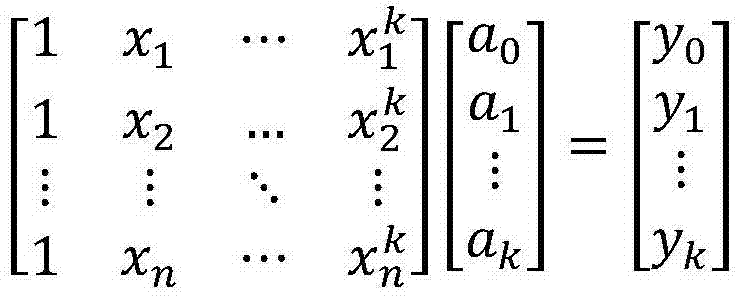

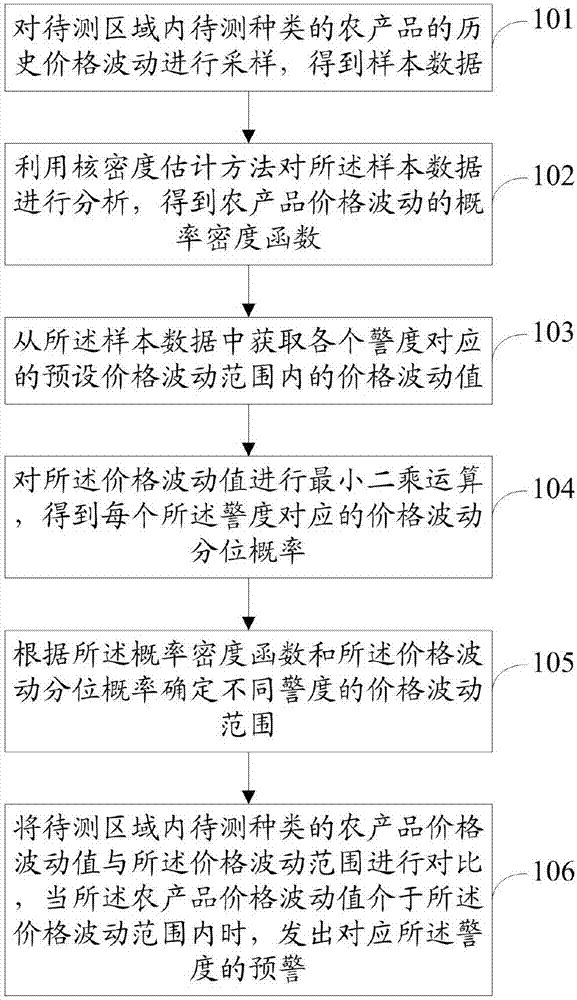

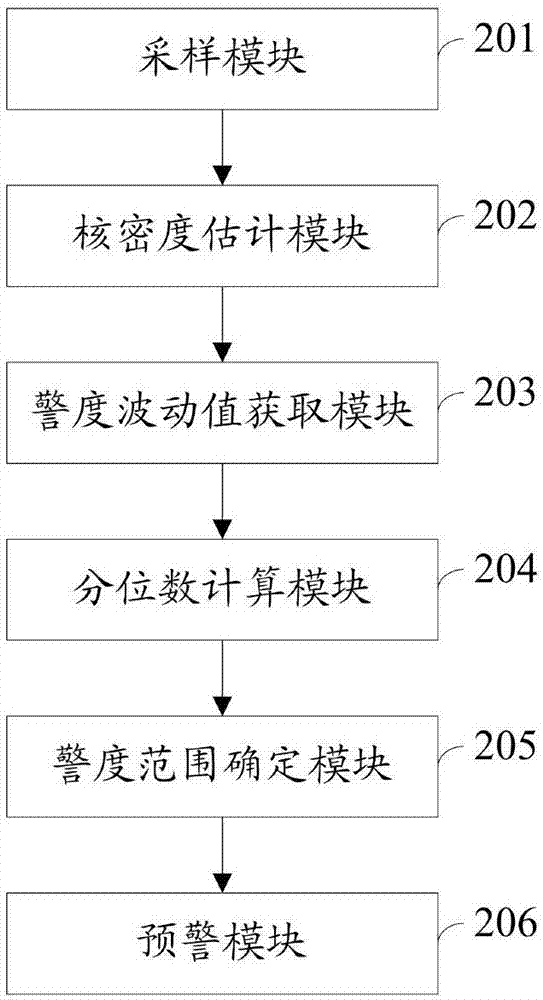

Agricultural product price fluctuation early warning method and system

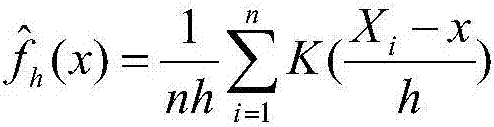

InactiveCN107274298APrice fluctuation warningPrice fluctuations are accurateMarketingNormal densityEstimation methods

The invention discloses an early warning method and system for price fluctuations of agricultural products. The method includes: sampling the historical price fluctuations of agricultural products of the type to be tested in the area to be tested to obtain sample data; analyzing the sample data by using the kernel density estimation method to obtain the probability density function of price fluctuations of agricultural products; obtaining each alarm from the sample data. The price fluctuation value within the preset price fluctuation range corresponding to the warning degree; the least squares operation is performed on the price fluctuation value to obtain the price fluctuation quantile probability corresponding to each warning degree; according to the probability density function and the price fluctuation quantile probability, different warnings are determined. The range of price fluctuations; compare the price fluctuation value of agricultural products of the type to be tested in the area to be tested with the price fluctuation range, and when the price fluctuation value of agricultural products is within the price fluctuation range, an early warning corresponding to the degree of warning will be issued. The method and system disclosed in the invention can accurately warn the price fluctuation of agricultural products, and improve the objectivity of analyzing the price fluctuation of agricultural products.

Owner:AGRI INFORMATION INST OF CAS

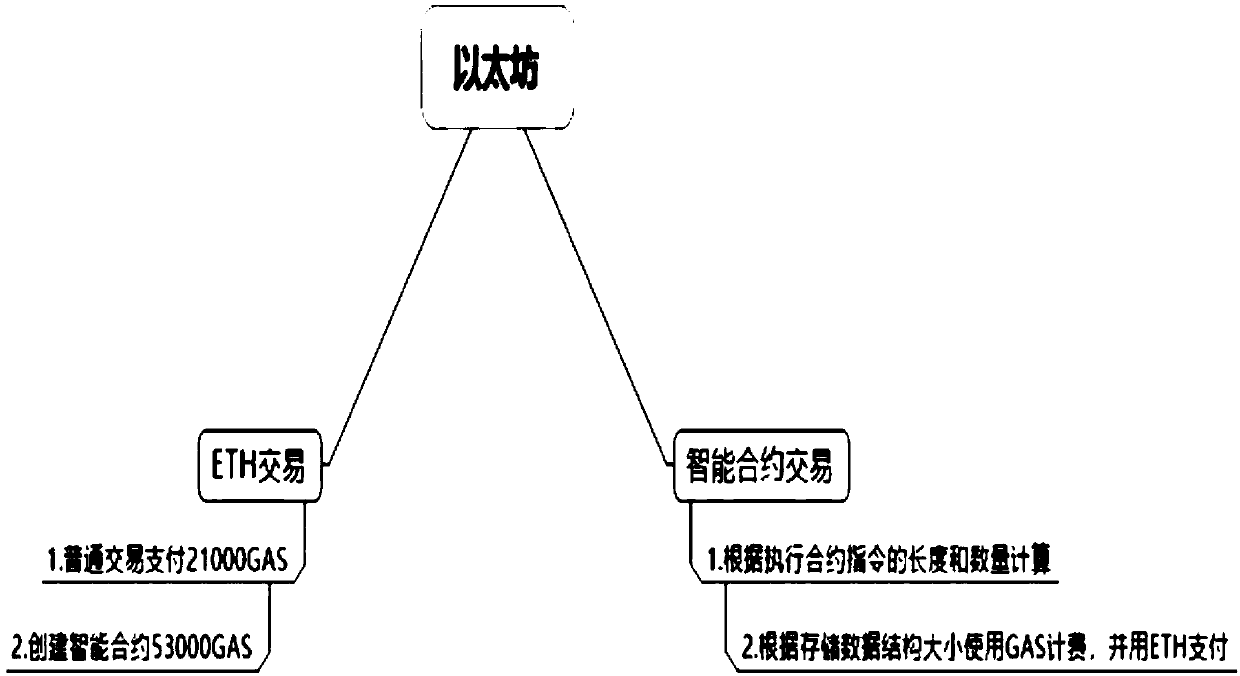

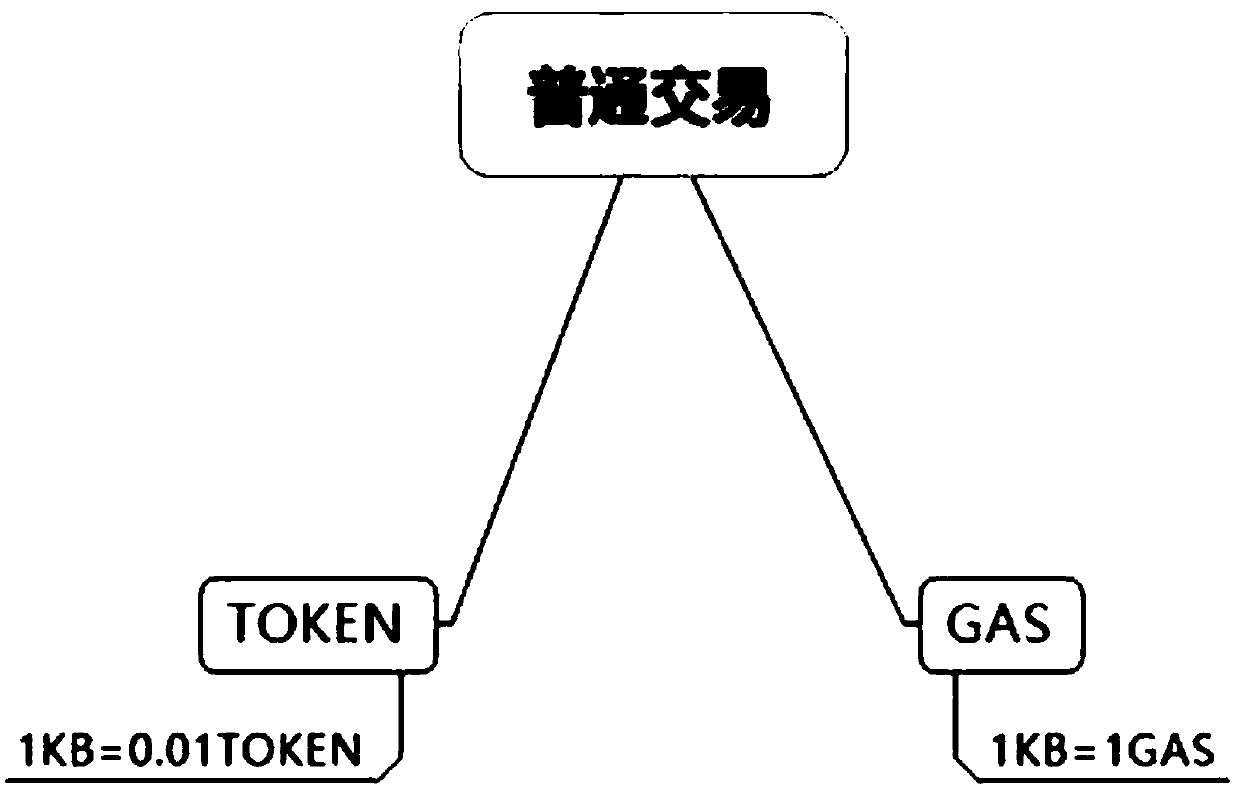

Blockchain-based multi-currency transaction fee collection method

InactiveCN108681891AFlexible configurationReduce participationFinancePayment circuitsPaymentCollection methods

The invention discloses a blockchain-based multi-currency transaction fee collection method. The method comprises the following steps of calculating a commission according to a transaction size, preferentially using gas billing and directly switching the token billing if a gas payment fee is insufficient, and completely transferring normal transaction gas and using token billing if a transaction currency is token. According to the method, the transaction cost is reduced by optimizing a transaction fee, the billing token is distinguished to be in a relatively stable range, and the price fluctuation is small. The participation of the mining machine is reduced, resources are saved, the difficulty of mining is reduced, a mining reward mechanism is canceled, the time of block out is improved, speculative behaviors are reduced, the transaction cost can be flexibly set, and the method is suitable for different business needs.

Owner:WEALEDGER NETWORK TECH CO LTD

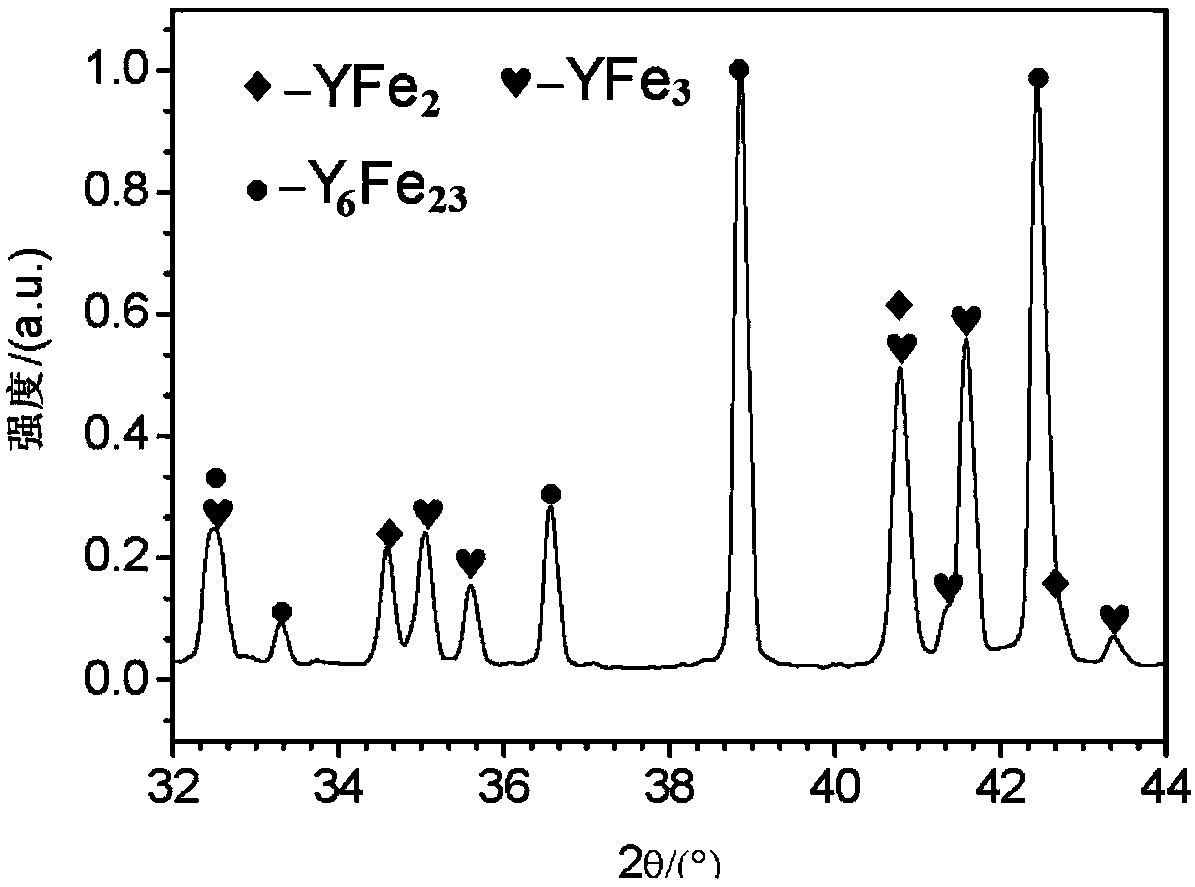

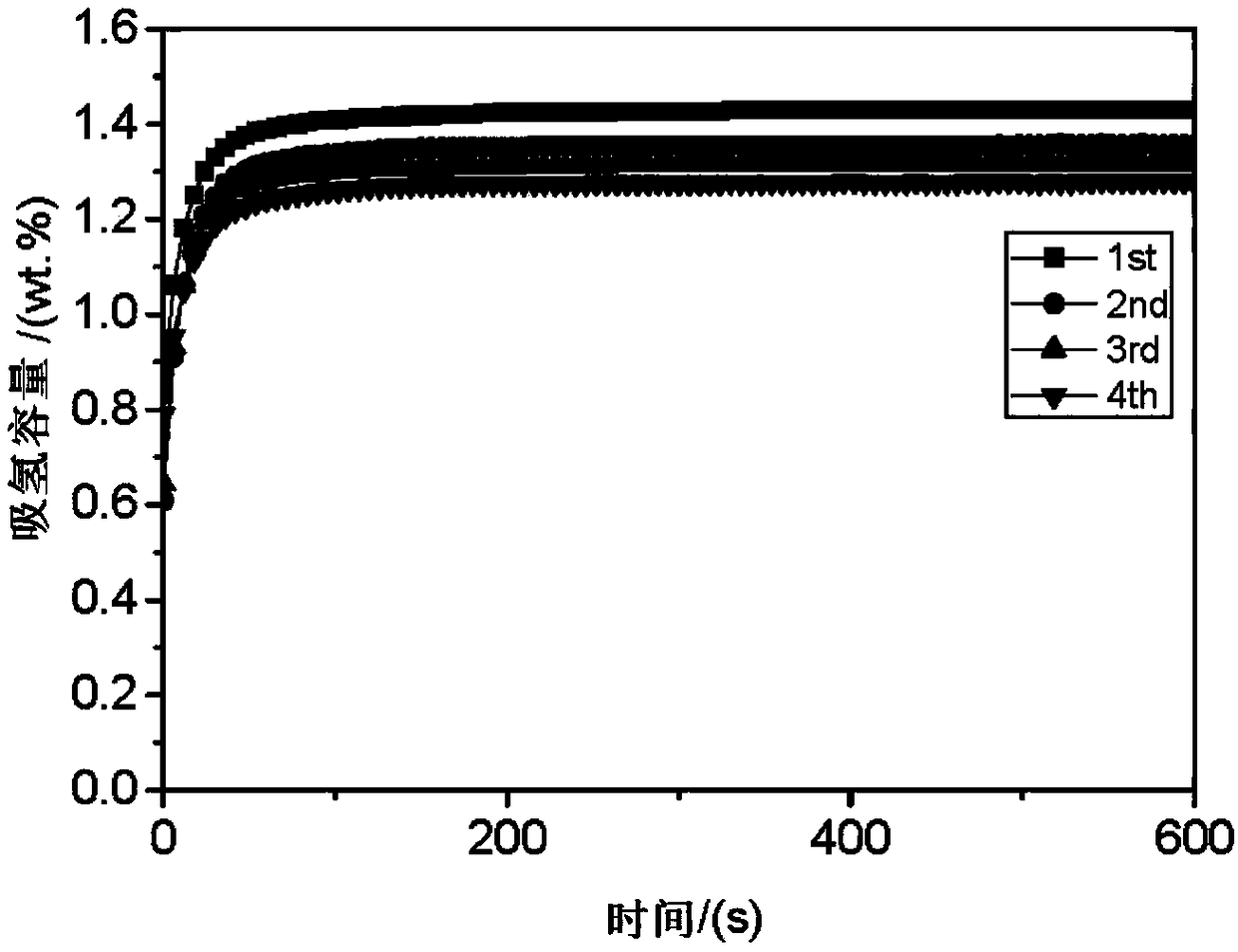

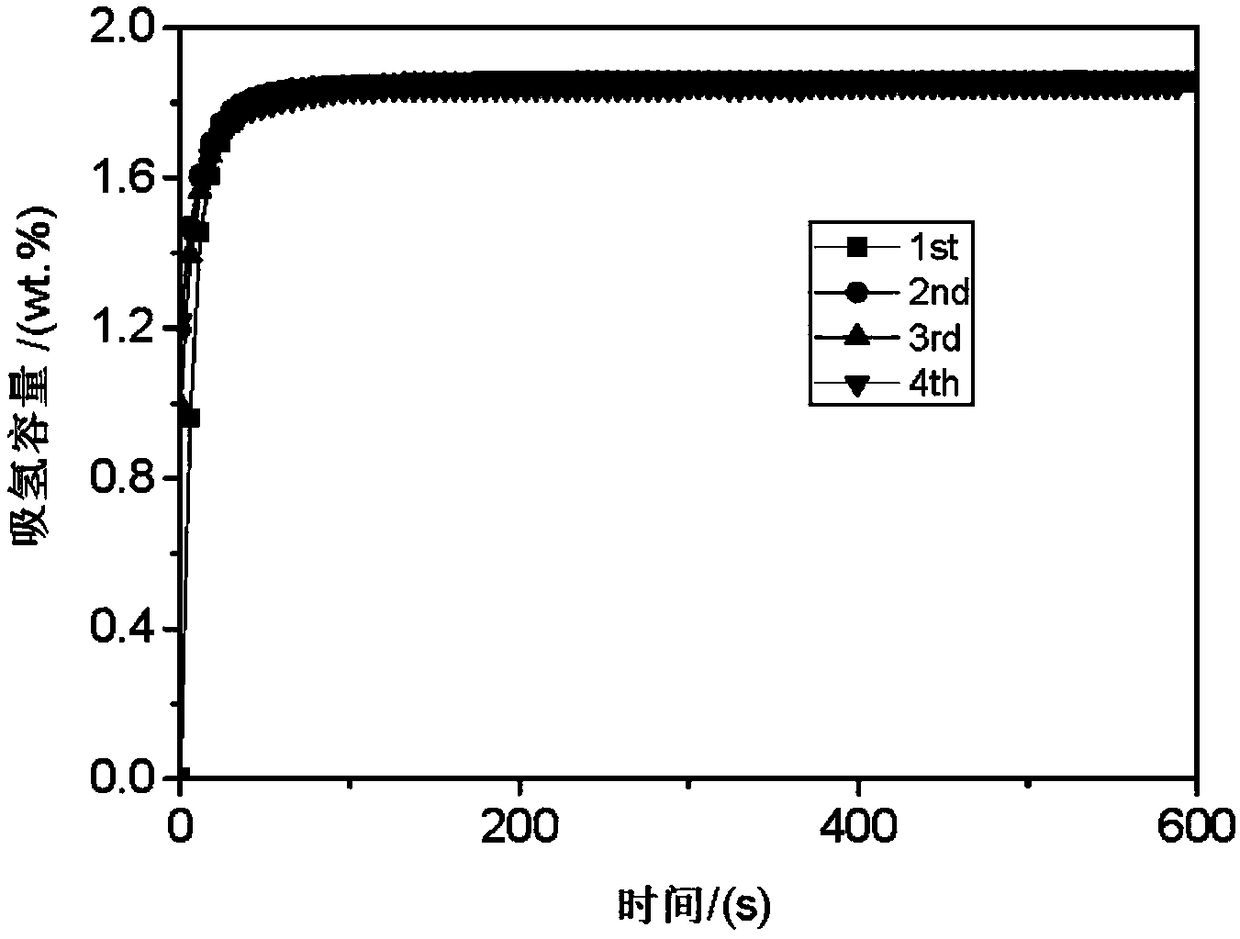

Y-Fe-based rare-earth hydrogen storage material and preparation method thereof

InactiveCN108220739ALow activation temperatureFast hydrogen absorption rateElectric arc furnaceRare earth

The invention discloses a Y-Fe-based rare-earth hydrogen storage material and a preparation method thereof. The component composition of the hydrogen storage material is Y1-xMxFe3-yNy, wherein x is not less than 0 and not greater than 0.5; y is not less than 0 and not greater than 1.5; M is one or more than two of La, Ce, Pr, Nd, Sm, Gd, Zr, Ti and Mg; and N is one or more than two of Ni, Co, Al,Mn and Ca. The preparation method thereof comprises the following steps: (1) material preparation: weighing pure metals or the alloys thereof according to the chemical composition components separately, carrying out cleaning treatment on the raw materials, and then carrying out roasting degassing; (2) smelting: smelting through a vacuum medium-frequency induction smelting furnace or a vacuum electric-arc furnace; (3) pouring: rapidly condensing to obtain a cast ingot in a manner of water-cooling die pouring or vacuum suction casting; and (4) crushing the cast ingot under the protection of argon gas atmosphere, and sieving to obtain a particle powder with a particle size of 30-40 meshes. The hydrogen storage material disclosed by the invention is low in activation temperature, high in hydrogen absorption speed, and applicable to many fields of energy storage, hydrogen purification and the like. Compared with La-Ni-series hydrogen storage materials, Fe is lower in price fluctuation thanNi and lower in material cost.

Owner:GRIMAT ENG INST CO LTD

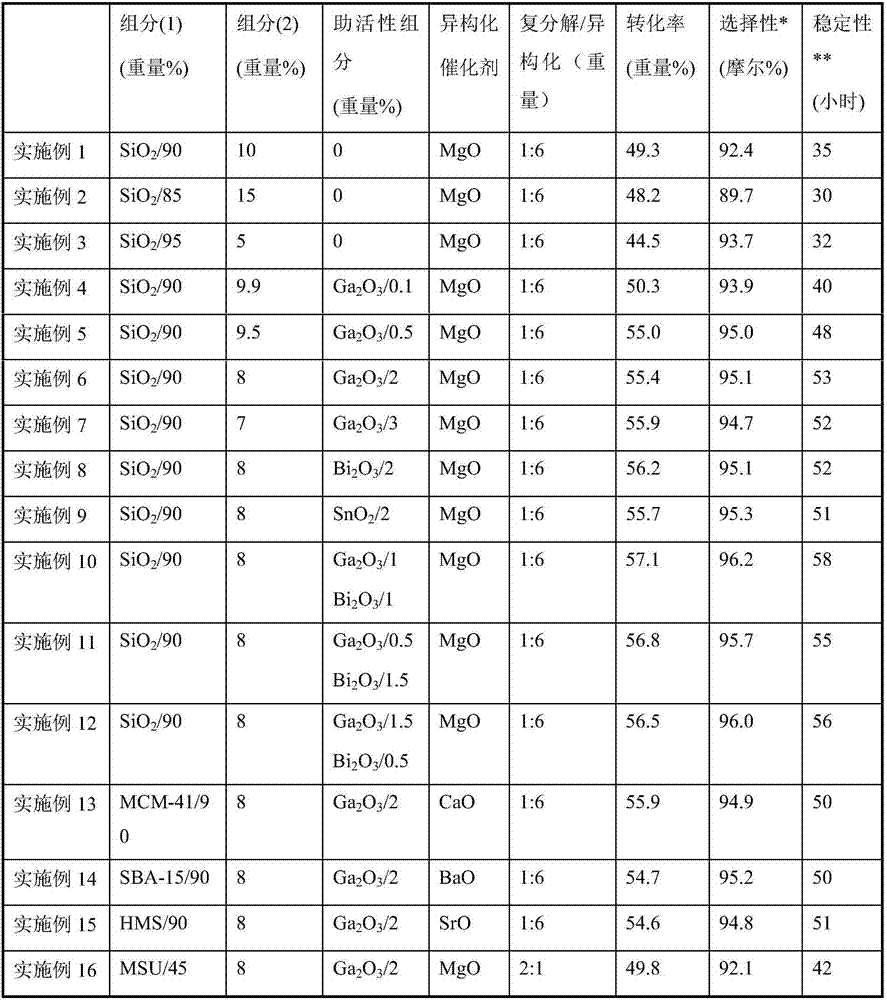

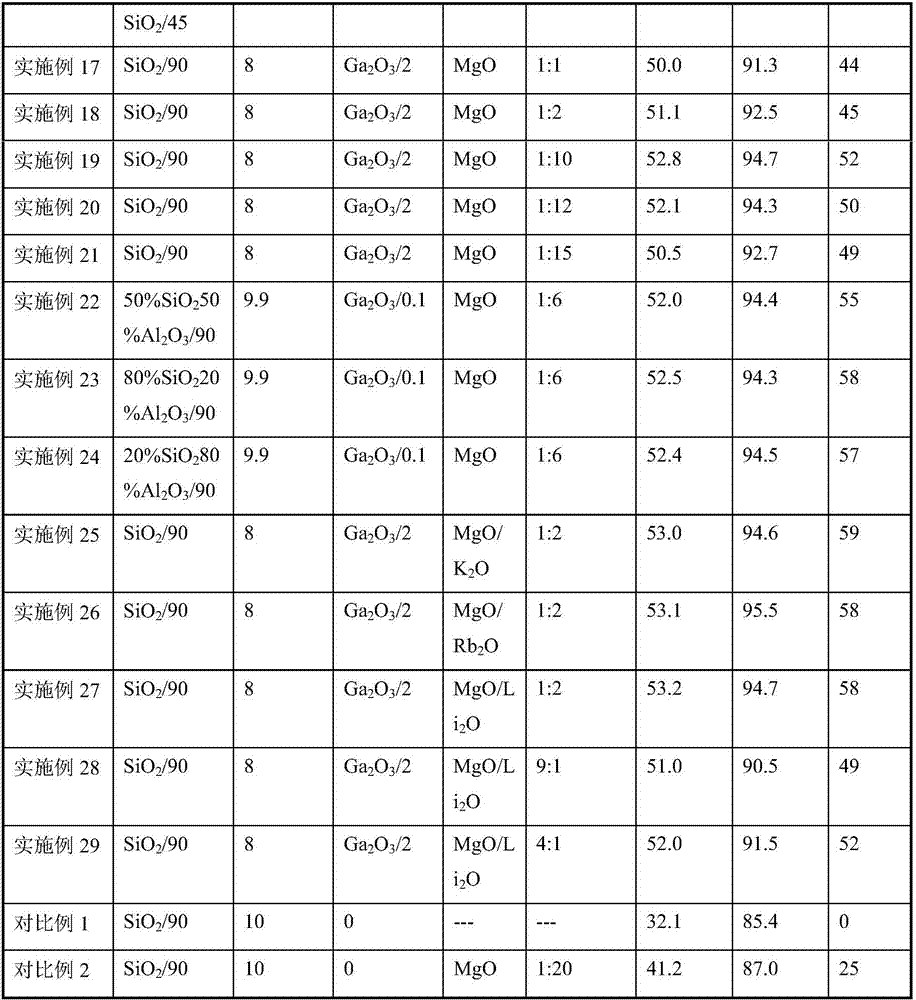

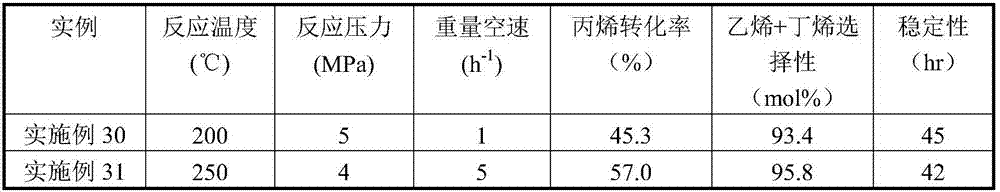

Method for preparing ethylene through disproportionation of propylene

ActiveCN107973684AMolecular sieve catalystsHydrocarbon by metathesis reactionIsomerizationPolymer science

The invention relates to a method for preparing ethylene through disproportionation of propylene. In the prior art, the technology is single, is only used for the propylene preparation technology through disproportionation of ethylene and butylene, and cannot be flexibly adjusted along with the price fluctuation of the product on the market, and the catalyst is easily deactivated in the propylenedisproportionation reaction. A purpose of the present invention is mainly to solve the problems in the prior art. According to the technical scheme of the present invention, ethylene is used as a rawmaterial, the raw material and a catalyst composition are subjected to a contact reaction to obtain ethylene, and the catalyst comprises, by weight, 5-99 parts of a double decomposition catalyst and 1-95 parts of an isomerization catalyst. With the technical scheme, the problems in the prior art are well solved. With the method of the present invention, the product structure can be flexibly adjusted according to the price fluctuation of the product on the market while the device, the catalyst and the process during the adjusting remain the unchanged states, the economic cost is low, and the method can be used for the industrial production of ethylene through olefin disproportionation.

Owner:CHINA PETROLEUM & CHEM CORP +1

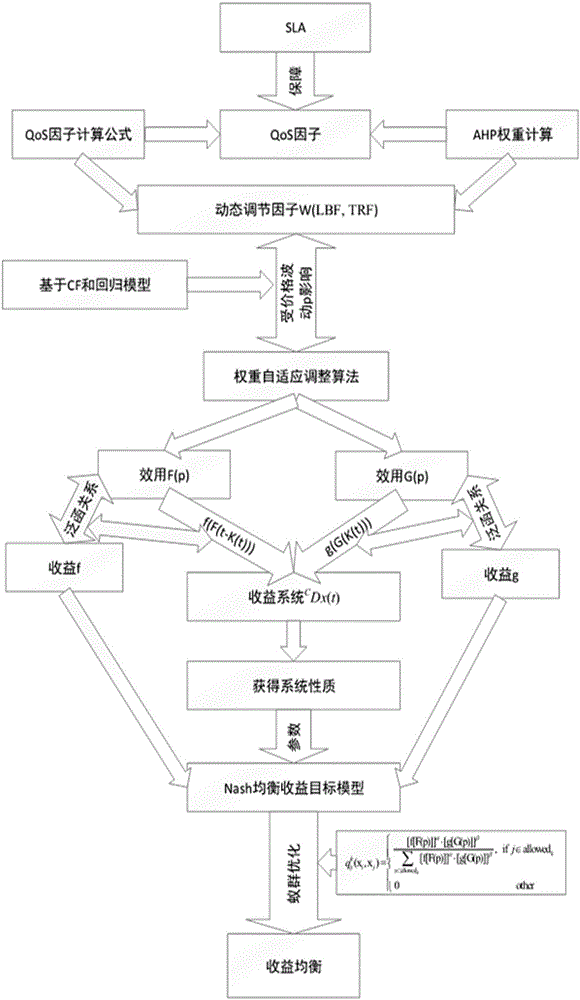

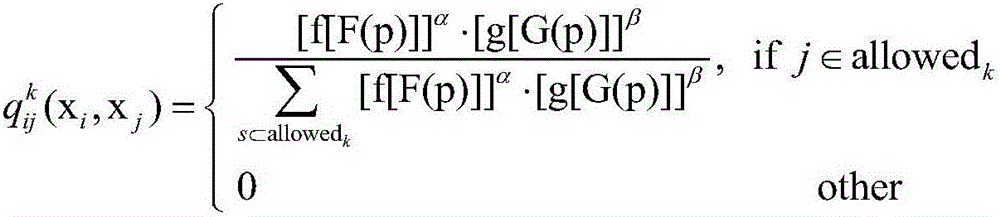

Cloud computing service revenue method for SLA (Service Level Agreement) guaranteed QoS (Quality of Service) expectation

InactiveCN106779283AImprove revenue efficiencyOvercoming situations of low satisfactionResourcesService-level agreementRevenue efficiency

The invention belongs to the field of cloud computing services, and specifically provides a cloud computing service revenue method for an SLA (Service Level Agreement) guaranteed QoS (Quality of Service) expectation. According to the invention, an existing SLA guaranteed QoS method is promoted through a QoS quantification factor calculation formula and an adaptive weight allocation algorithm, circumstances of low QoS satisfaction degree and the like in a dynamic pricing mechanism are effective overcome. In addition, a utility function modeling based cloud computing service performance mechanism is built through dynamic price fluctuation quantities, a fractional order revenue system is established by taking a performance-utility model as functional relation, a Nash equilibrium revenue objective model and an ant colony optimization algorithm are established, and the cloud computing service revenue efficiency is improved.

Owner:SICHUAN TOURISM UNIV +1

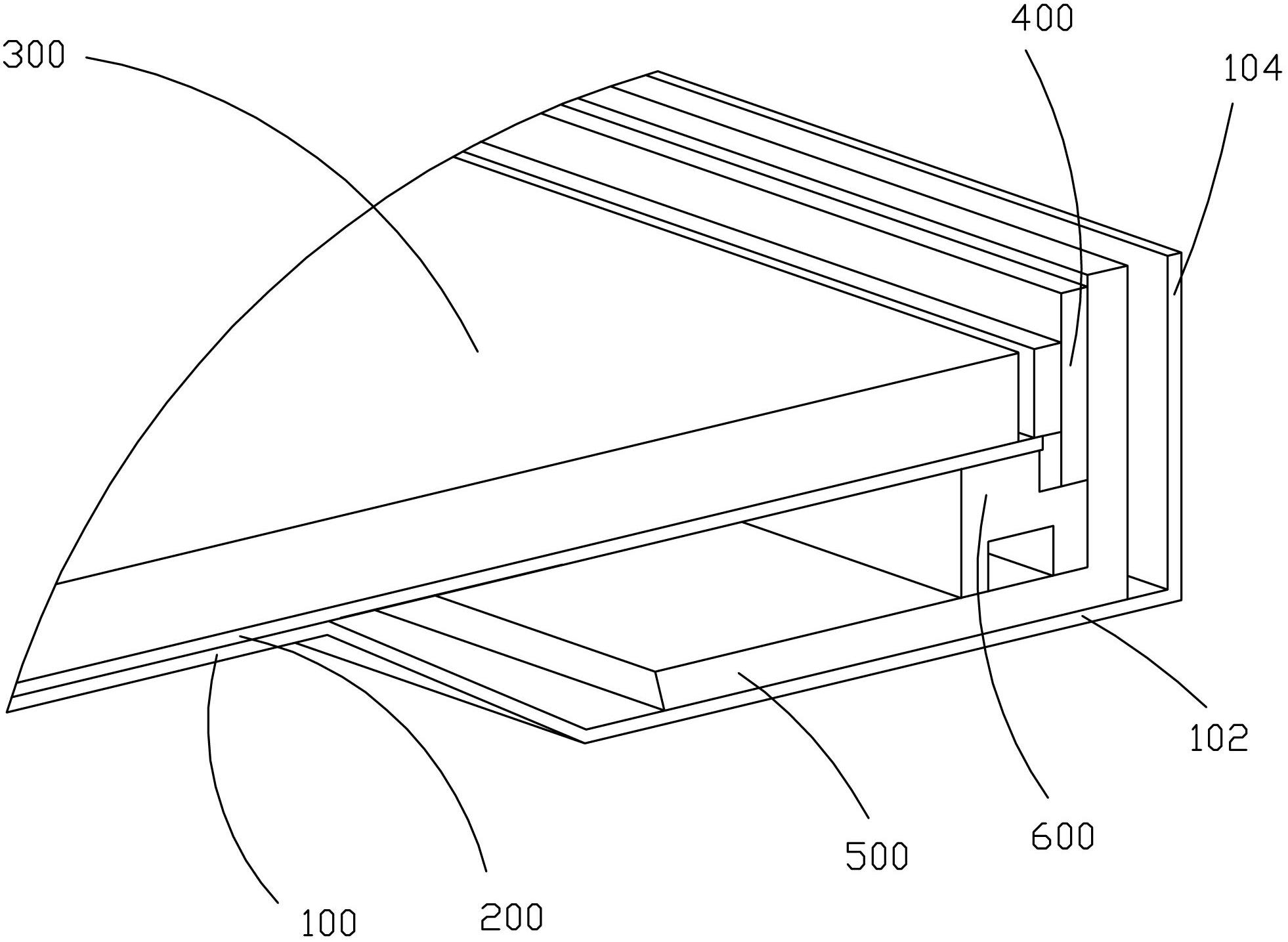

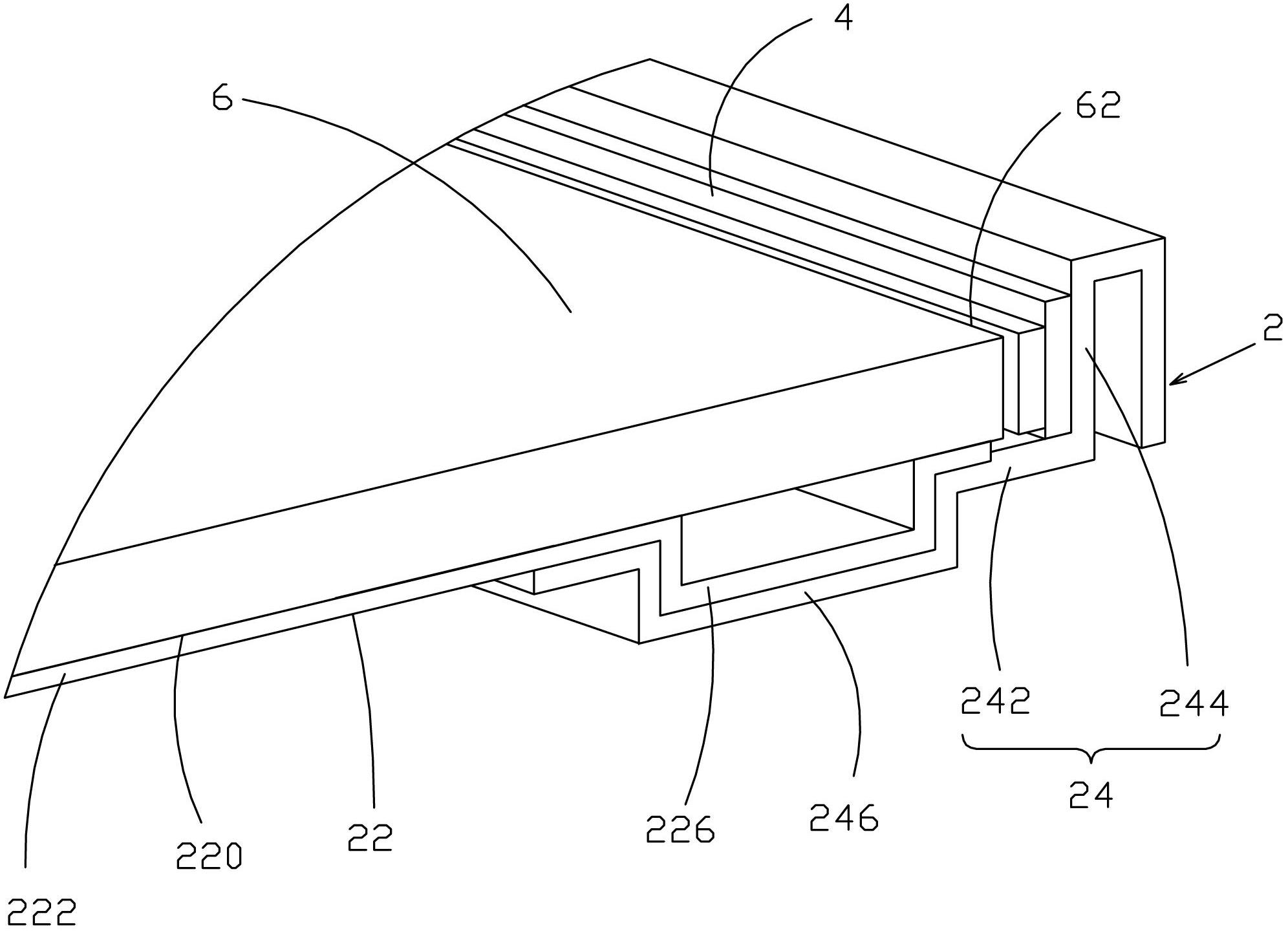

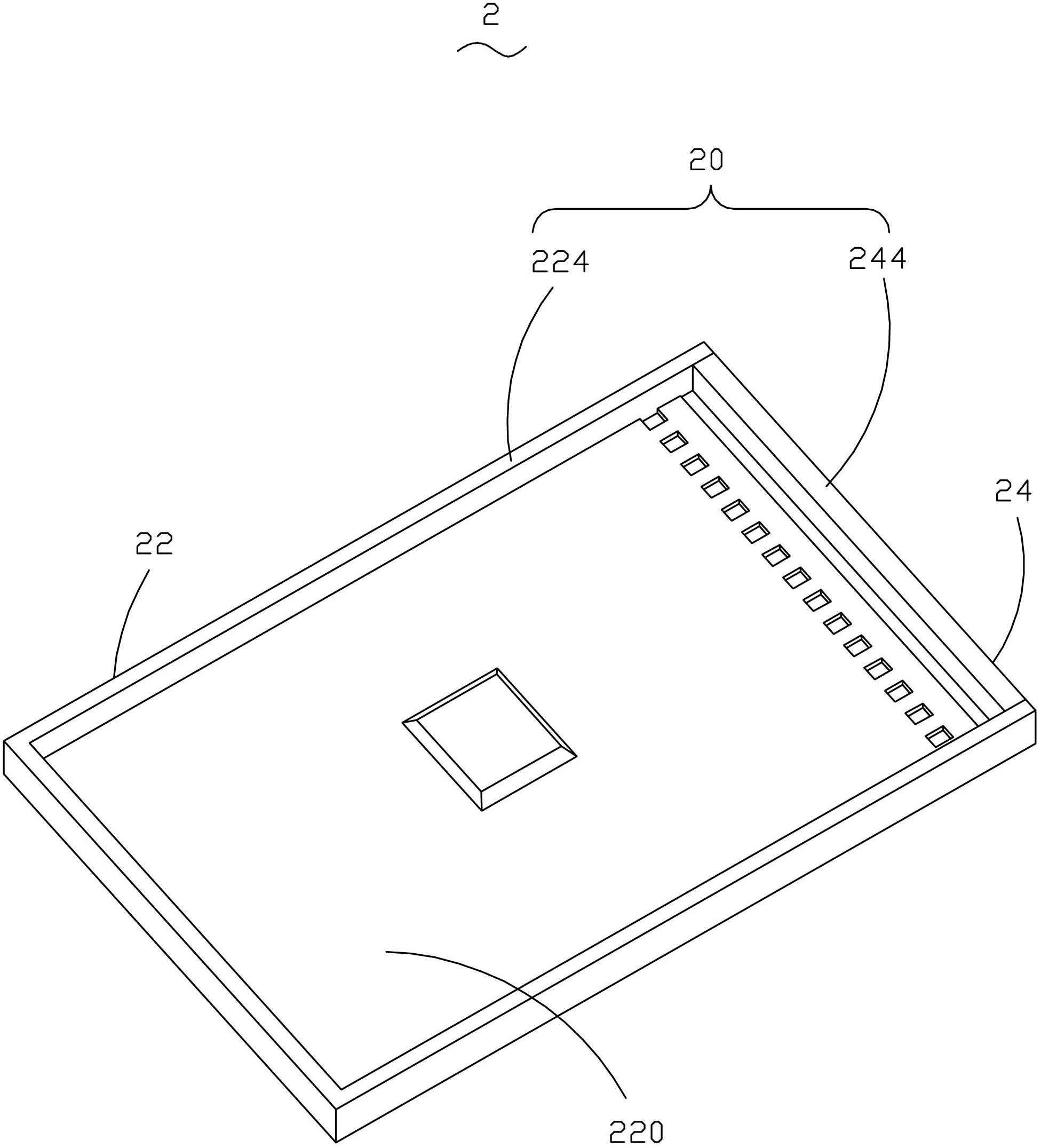

Edge type backlight module

InactiveCN102691940AAchieve lightweightReduce usageMechanical apparatusLighting support devicesPlastic materialsLight guide

The invention provides an edge type backlight module, which includes a back panel, a backlight source arranged in the back panel and a light guide plate arranged in the back panel, wherein the back panel includes a main body and a bracket connected with the main body, the main body is made of plastic materials, the bracket is made of metal materials, and the backlight source is mounted on the bracket. Though adopting the back panel formed by combining the plastic main body and the metal bracket, the weight of the edge type backlight module is light; as more plastic materials can be selected, the defects of simplex raw material and significant price fluctuation in the existing back panel are further overcome, and the production cost is efficiently lowered; moreover, the main body is directly provided with a reflection surface, so that the use of a reflective sheet is avoided, the installation of the light guide plate is facilitated, and the production cost is further lowered.

Owner:TCL CHINA STAR OPTOELECTRONICS TECH CO LTD

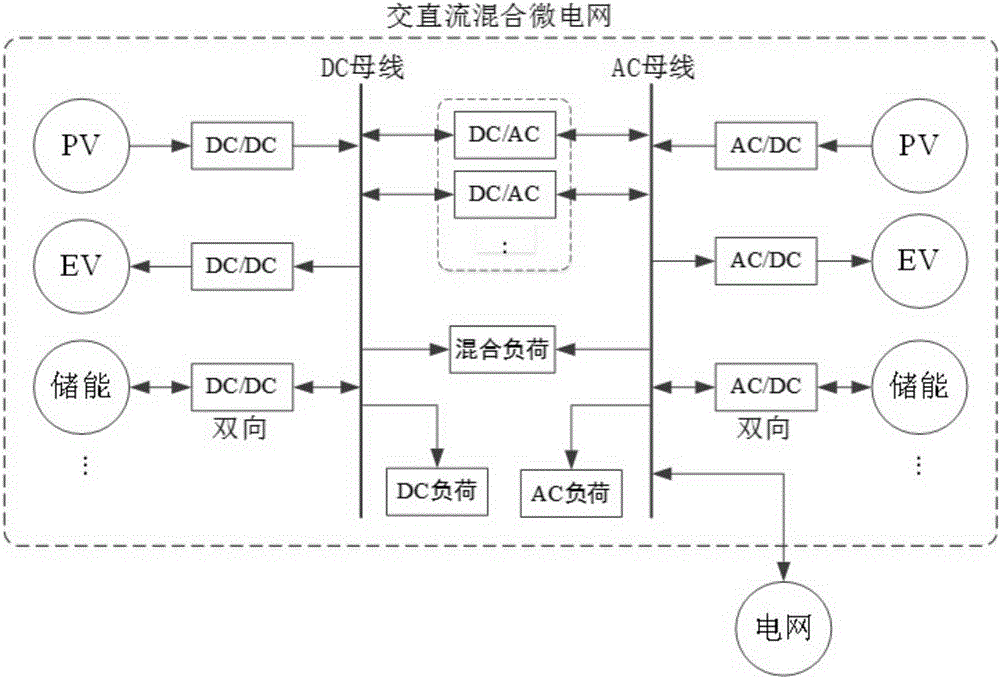

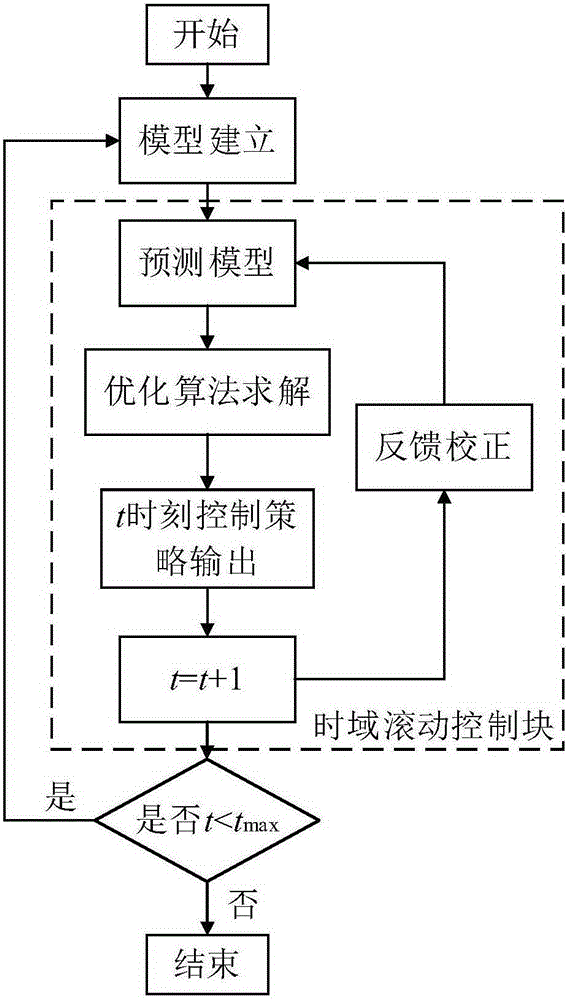

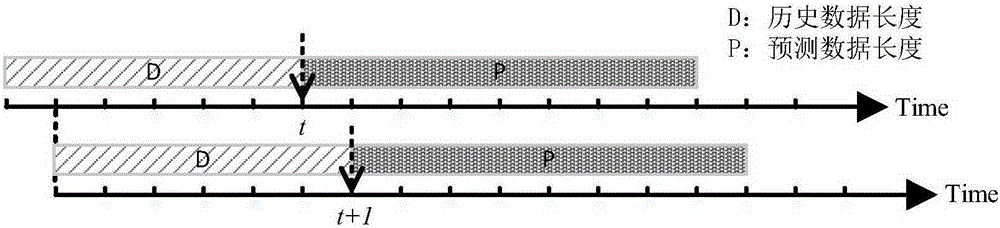

AC and Dc mixed micro-grid operation optimization method based on time-domain rolling control

The invention discloses an AC and Dc mixed micro-grid operation optimization method based on time-domain rolling control. The method comprises: (1) establishing an AC and DC mixed micro-grid linear model, (2) establishing a distributed power supply output prediction and AC and DC load prediction model, (3) establishing an optimization target function comprising robustness and economy performance, and selecting appropriate optimization targets according to different operation sates of grid-connected operation and off-grid operation of an AC and DC mixed micro-grid, (4) through adoption of a time-domain rolling control method, performing optimization control on a target power distribution network, and (5) performing the rolling time-domain control, and repeating the steps (2)-(4) at t+1 moment until the control ends. Influences brought by renewable energy output power, an energy price fluctuation and a load prediction error are eliminated trough feedback corrections, and, aiming at the different operation states of the AC and DC mixed micro-grid, the different optimization targets are adopted to improve the robustness in the off-grid operation state and the economy performance in the grid-connected operation state.

Owner:SOUTHEAST UNIV

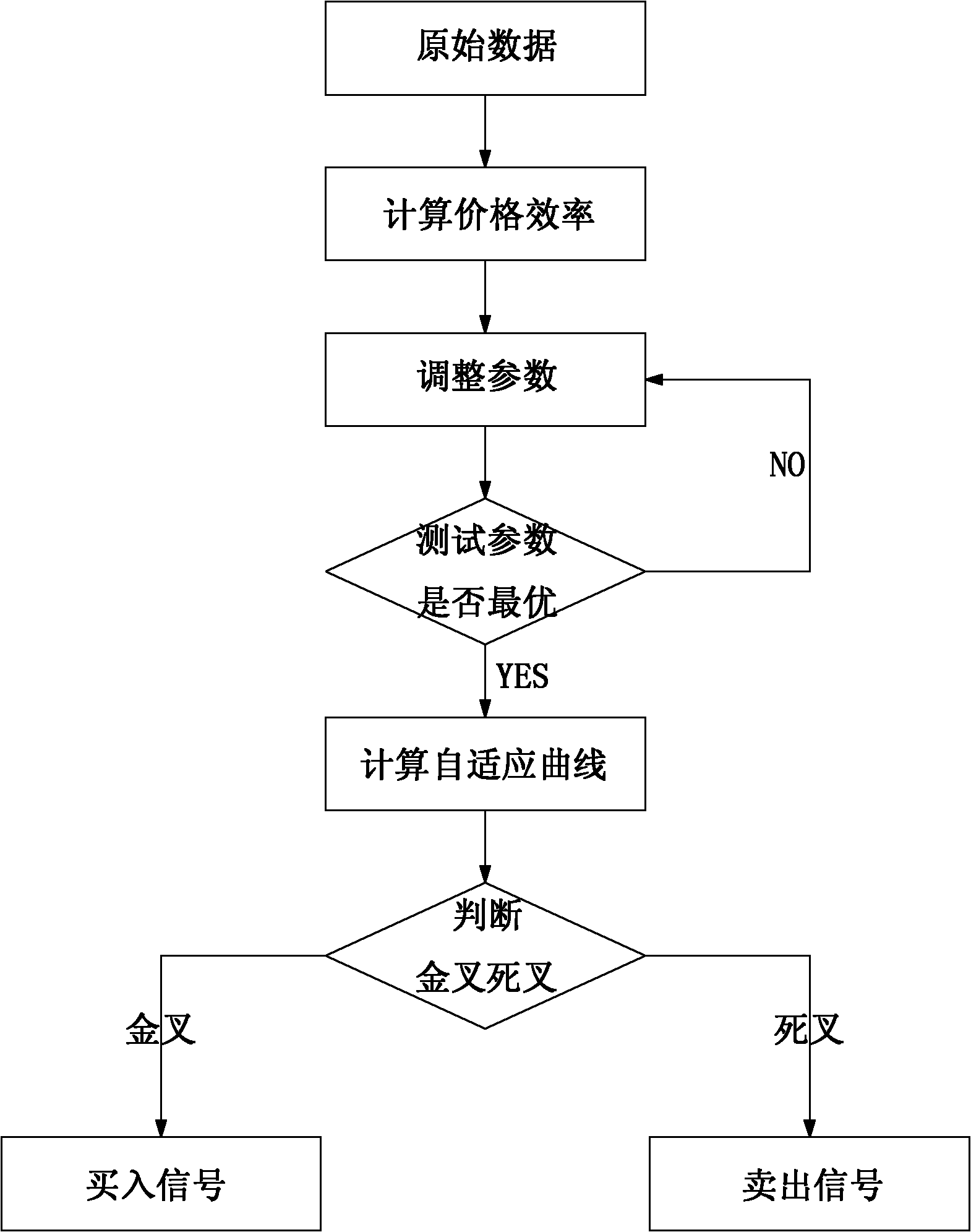

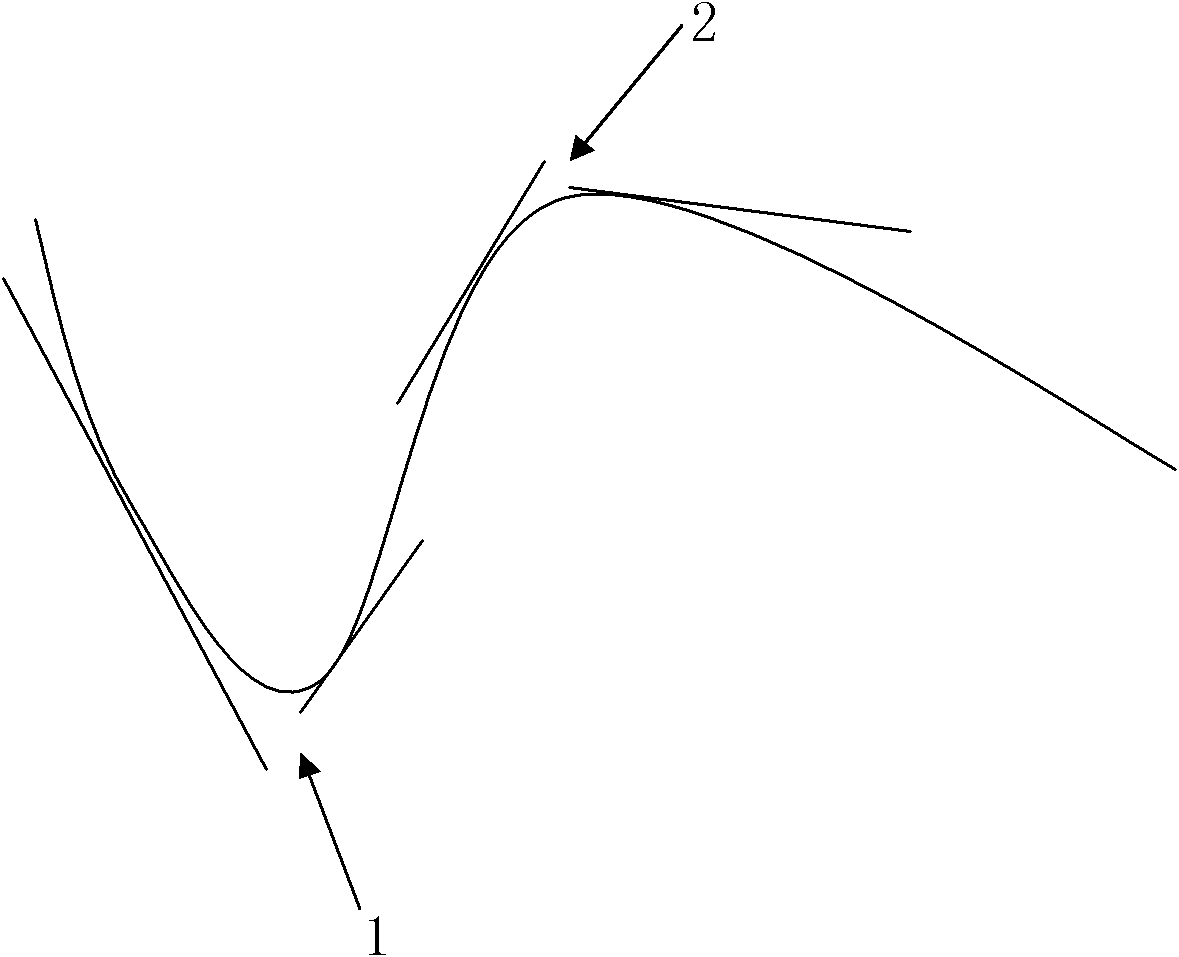

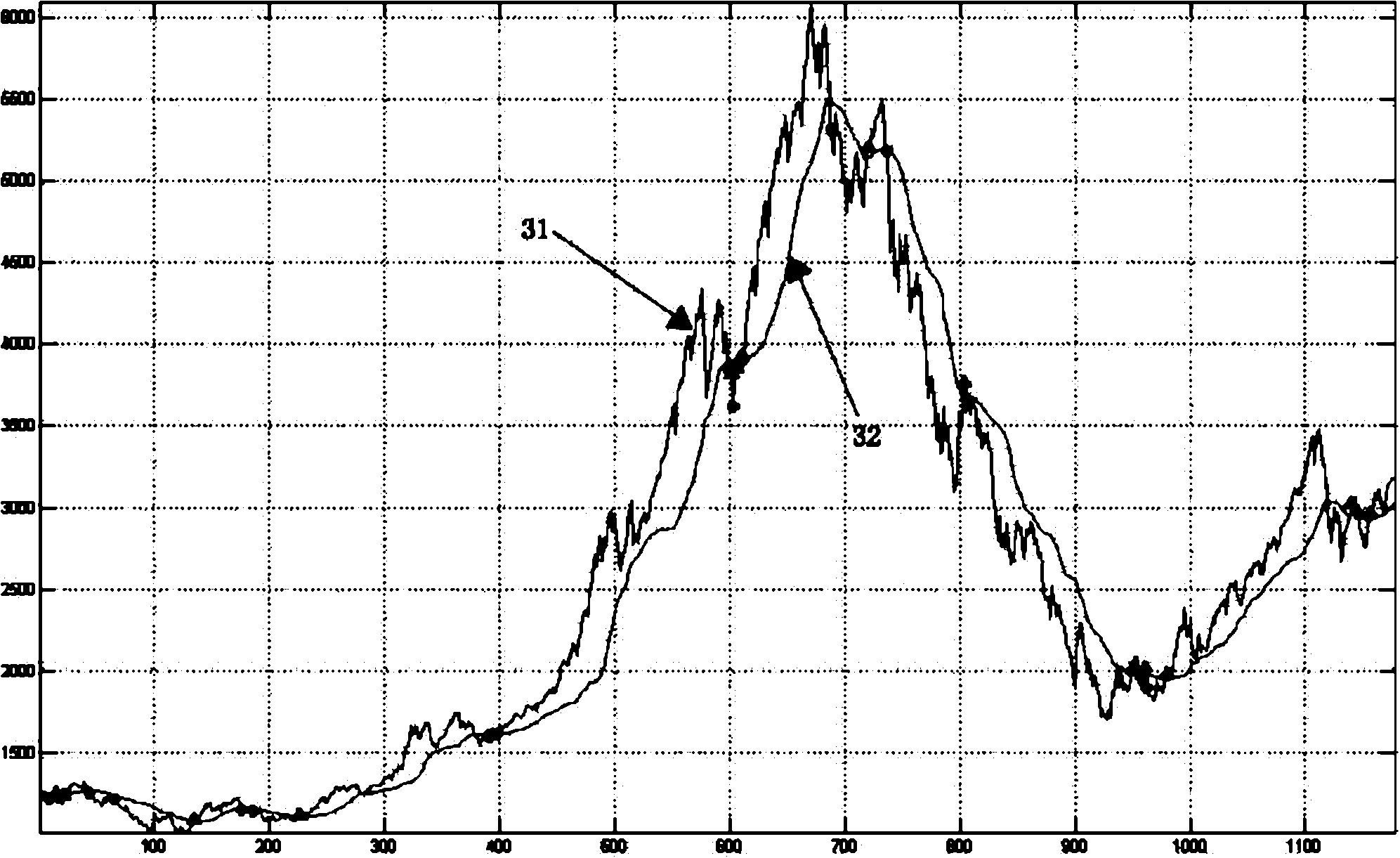

Calculation method of stock average line system intelligently adapting to market

The invention relates to the technical field of price data band judgment in a stock market, in particular to a calculation method of a stock average line system intelligently adapting to a market. The calculation method is characterized in that the stock average line is calculated by adopting a self-adaptive curvilinear equation, different weights and price fluctuation efficiency are introduced for describing the influence of past daily price on the stock average system, and the golden crossing and dead crossing of a self-adaptive curve and a price trend curve are used for guiding buying-selling operation. Compared with the prior art, the calculation method adopts the self-adaptive curve for calculating the stock average line and calculating optimized parameters, can intelligently adapt to the domestic stock market and timely judge buying-selling signals by the golden crossing and dead crossing with the price trend curve; and the calculation method is simple, convenient and feasible, thereby providing better investment references for investors.

Owner:上海万臣信息科技发展有限公司

System and method for predicting security price movements using financial news

A method of creating a price prediction model that forecasts short-term price fluctuations in financial instruments by collecting, analyzing and classifying financial news for a financial instrument into categories. Distributions for the changes in price of the financial instrument for a set period of time and distributions for the changes in price of the financial instrument as a result of the financial news for each news category for a set period of time are then obtained. If the distributions for the changes in price of the financial instrument are statistically significantly different than the distributions for the changes in price of the financial instrument for a particular news category, and the mean for the change in price is greater or less than zero, a signal is produced indicating the trading action that should be taken for the financial instrument.

Owner:PAPKA RON

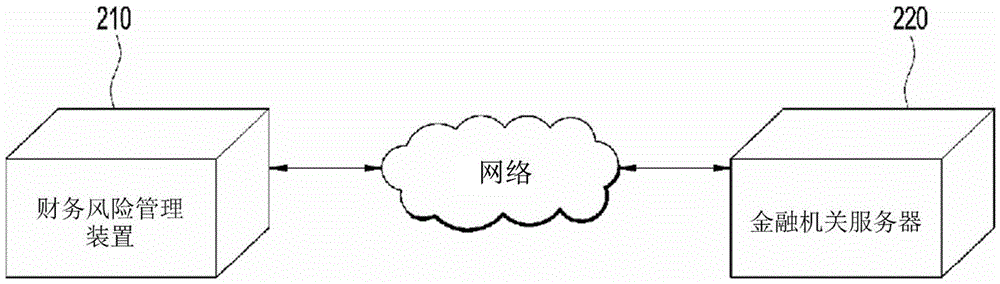

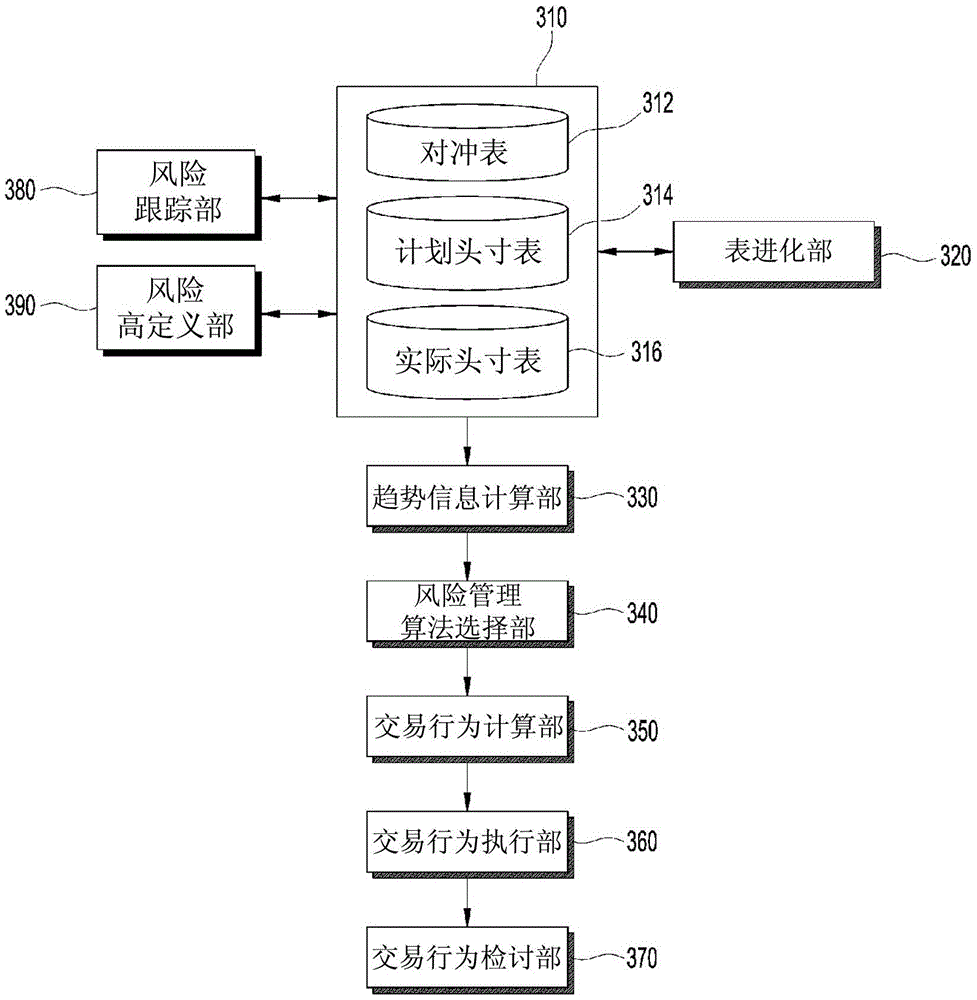

Method and apparatus for generating trade actions to manage financial risk, and recording medium storing program for executing method

InactiveCN105556548AEasy to getDoor/window protective devicesFinanceComputer sciencePrice fluctuation

The present invention relates to a method and an apparatus for generating trade actions to manage a financial risk, and a recording medium storing a program for executing the method. Provided are a method and an apparatus for generating trade actions, including selling, buying, holding and the point and amount of transaction, and a recording medium storing a program for executing the method. If financial risk management policies, including a risk management policy for financial statements and a current foreign exchange and a risk management policy for raw material price fluctuation, are inputted, the present invention enables derivation of a more suitable financial management policy by examining the inputted financial risk management policies through simulation. If the more suitable financial risk management policy is derived, objective and systematic trade actions are generated on the basis of the derived financial risk management policy. Accordingly, it is possible to inform a company of when and what trade action the company should take in a given market situation, in order to manage an intrinsic financial risk of the company, and why such a management policy is better than other management policies.

Owner:任晸浚

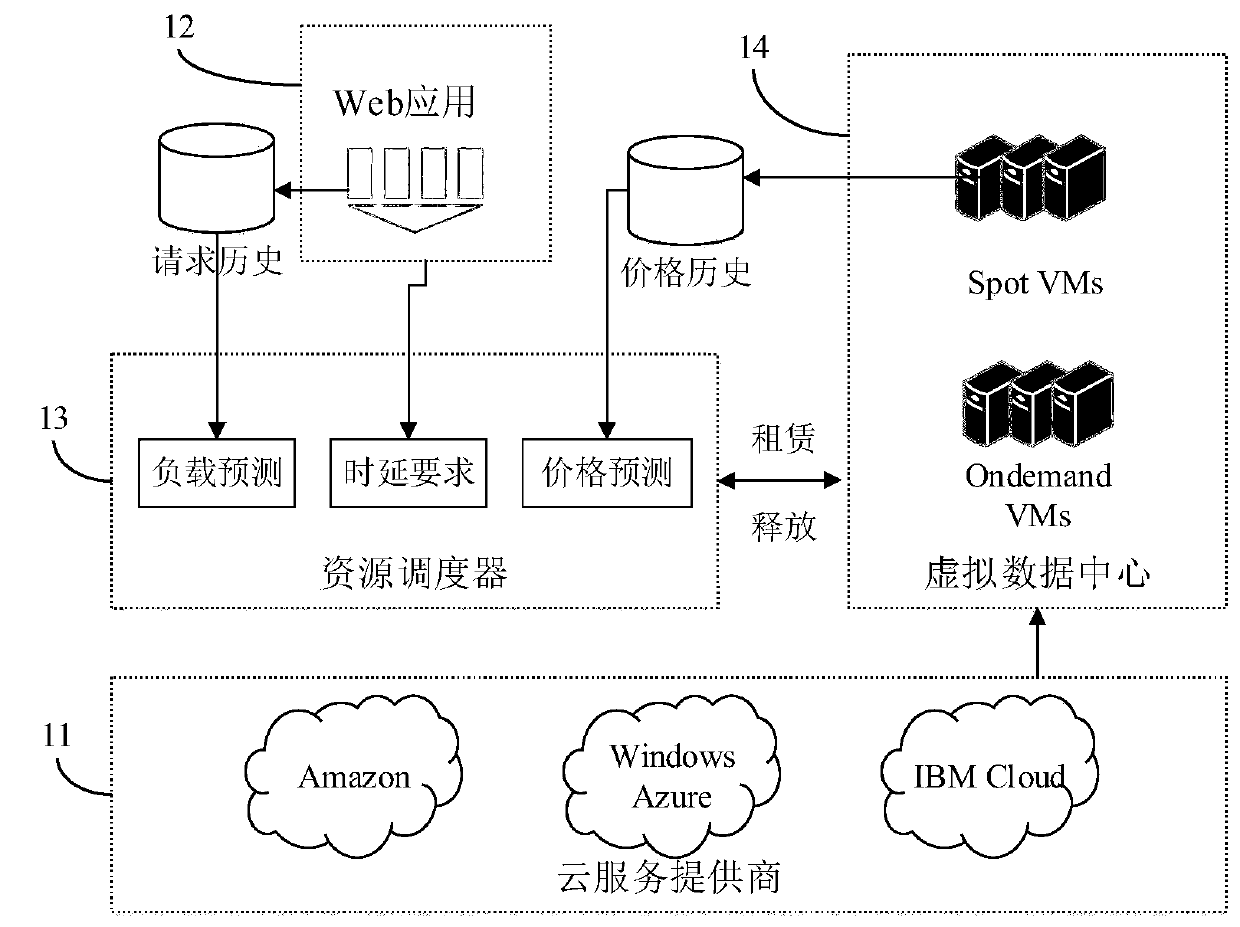

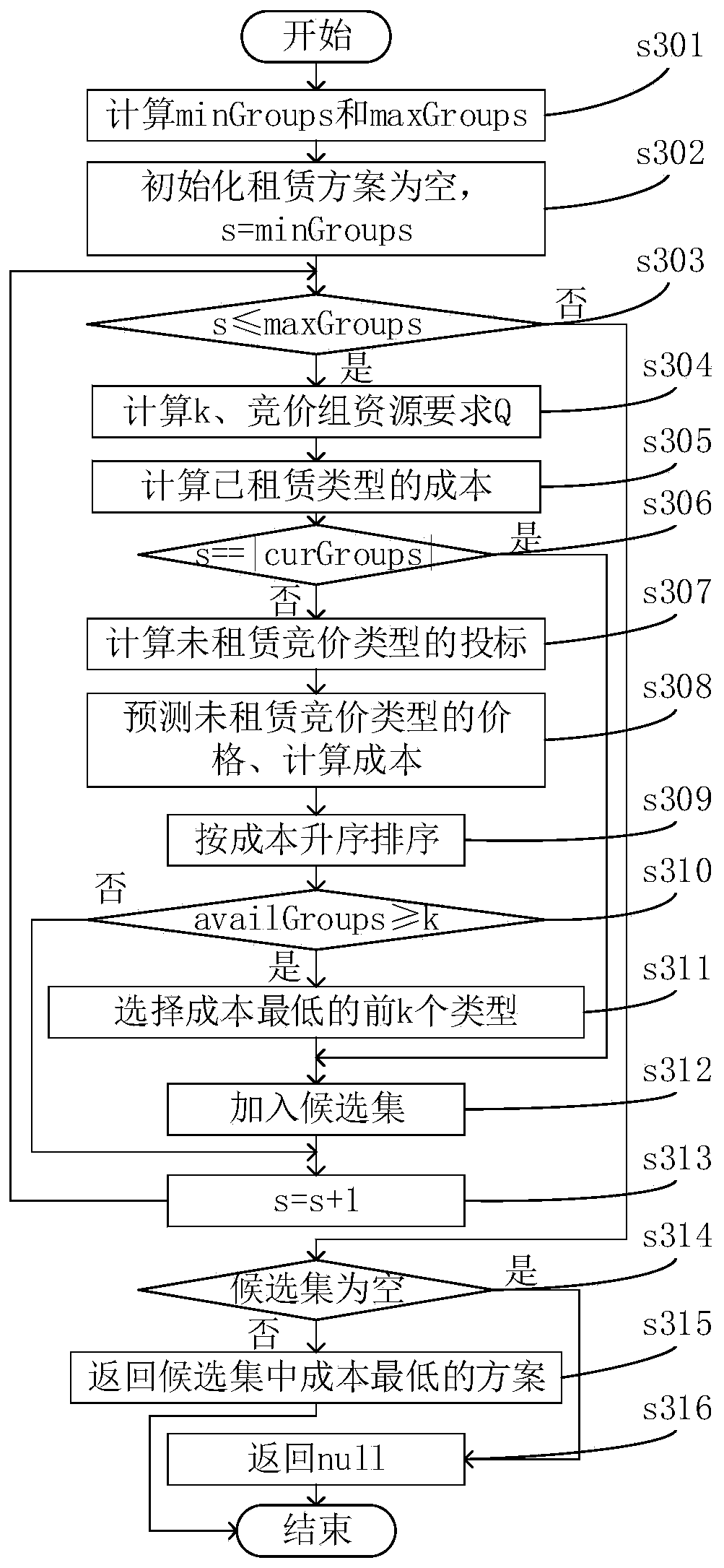

A resource dynamic scheduling method for a Web application in a cloud computing environment

ActiveCN109740870AOptimal Resource Leasing ScaleGuaranteed application effectBuying/selling/leasing transactionsResourcesWeb applicationDynamic resource

The invention discloses a resource dynamic scheduling method for a Web application in a cloud computing environment. Dynamic change of a user request, time delay requirements of the application, heterogeneity of cloud resources, price fluctuation of bidding examples and the like are considered. The method comprises the following steps: A) determining an optimal resource quantity based on load prediction and application delay requirements; B) selecting a bidding type with the lowest cost based on bidding instance price prediction; and C) adopting pre-leasing to reduce time delay increase causedby resource requests and creation. The method is mainly characterized by comprising the steps that A, prediction loads serve as the arrival rate of a queuing model, and the minimum number of virtualmachines needing to be leased is solved in combination with delay constraint of an application; The step B is mainly characterized in that a bidding type with the lowest prediction cost is selected for leasing based on price prediction; The step C is mainly characterized in that pre-leasing is carried out before a charging point arrives. According to the invention, dynamic resource scheduling is realized through load prediction, application delay constraint, price prediction and pre-leasing, and the cloud resource leasing cost can be reduced while the application performance is ensured.

Owner:NANJING UNIV OF SCI & TECH

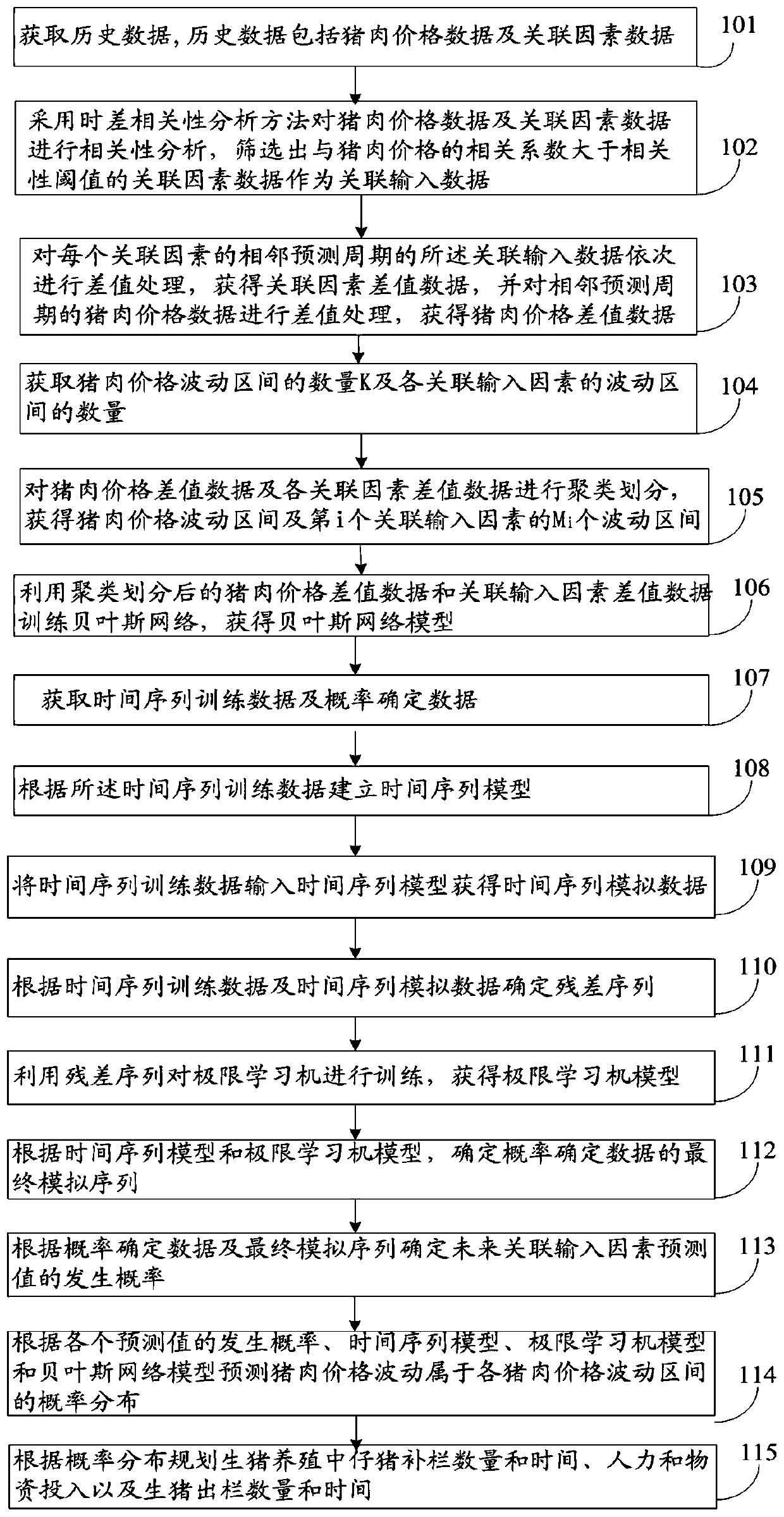

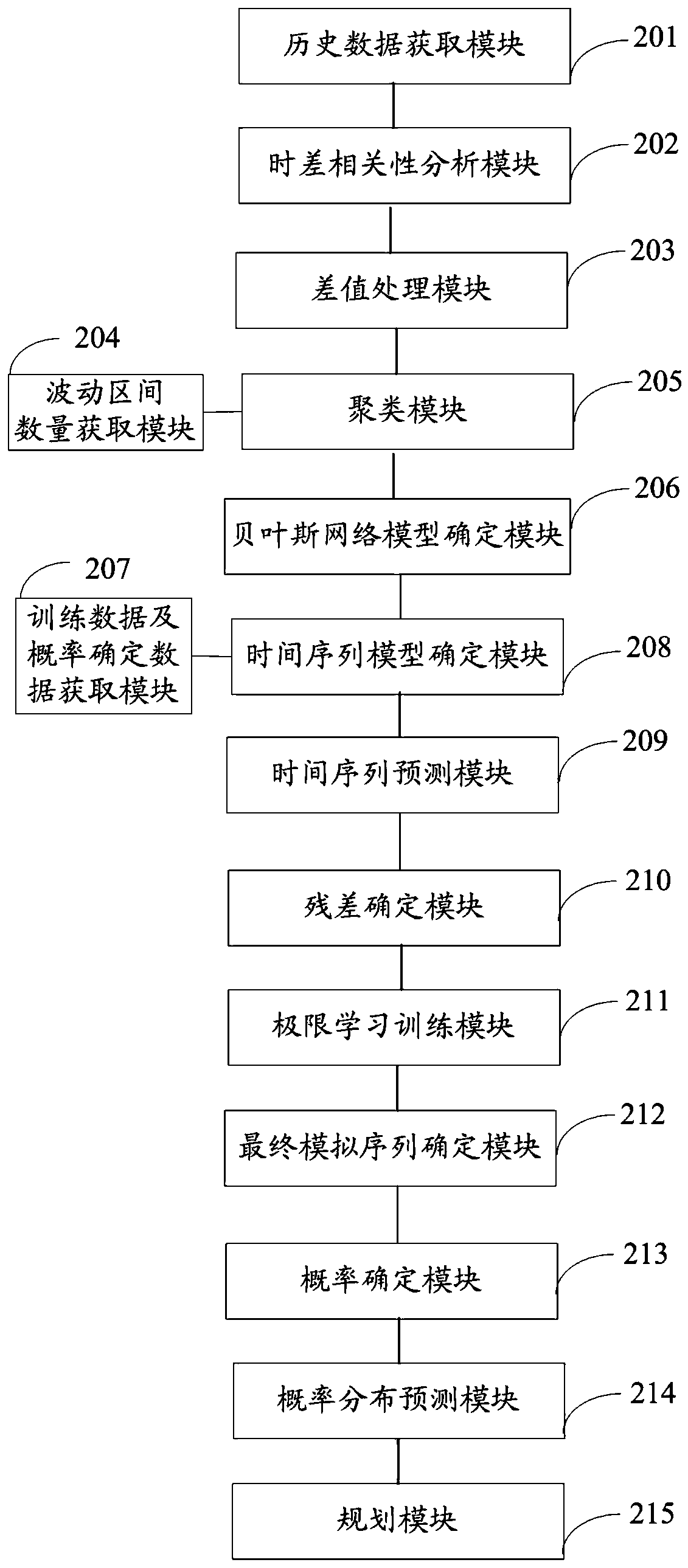

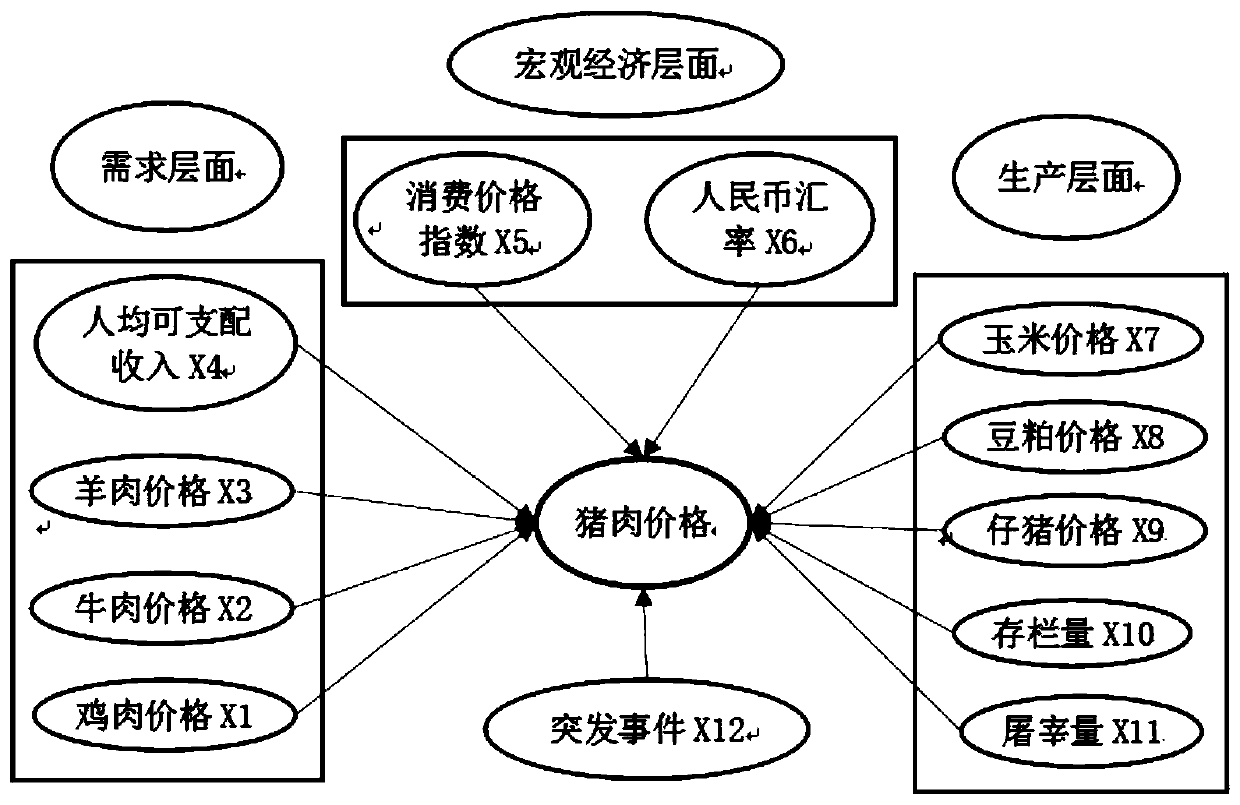

A live pig breeding planning method and system

InactiveCN109816236AGuaranteed benefitsImprove forecast accuracyCharacter and pattern recognitionResourcesLearning machinePig breeding

The invention discloses a live pig breeding planning method and system. According to the live pig breeding planning method and system provided by the invention, discretization classification processing is carried out on pork price fluctuation intervals and fluctuation intervals of all associated input factors through clustering analysis, and then discretization classification data are utilized totrain a Bayesian network model; then, the time sequence model is combined with the extreme learning machine, the prediction precision of input factors in the Bayesian network model is further improved, and finally, the probability distribution of pork price fluctuation belonging to each pork price fluctuation interval is predicted based on the visual causal dependency relationship between variables in the network. The pig breeding enterprises or farmers can plan piglet feeding quantity and time, manpower and material input and live pig slaughtering quantity and time in live pig breeding according to future price fluctuation probability distribution, waste of manpower and materials in the live pig breeding process is reduced, and the live pig breeding benefits are guaranteed.

Owner:AGRI INFORMATION INST OF CAS

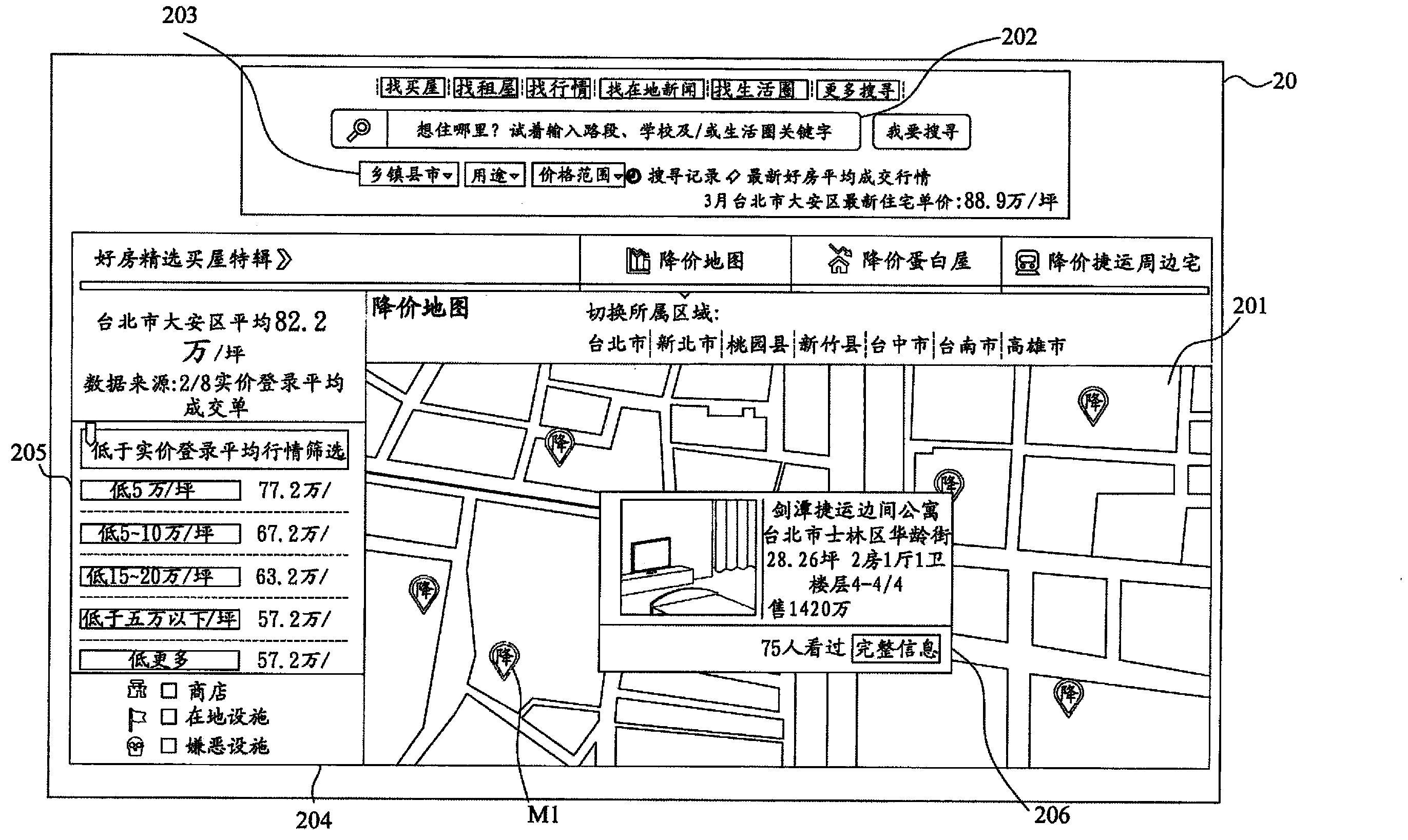

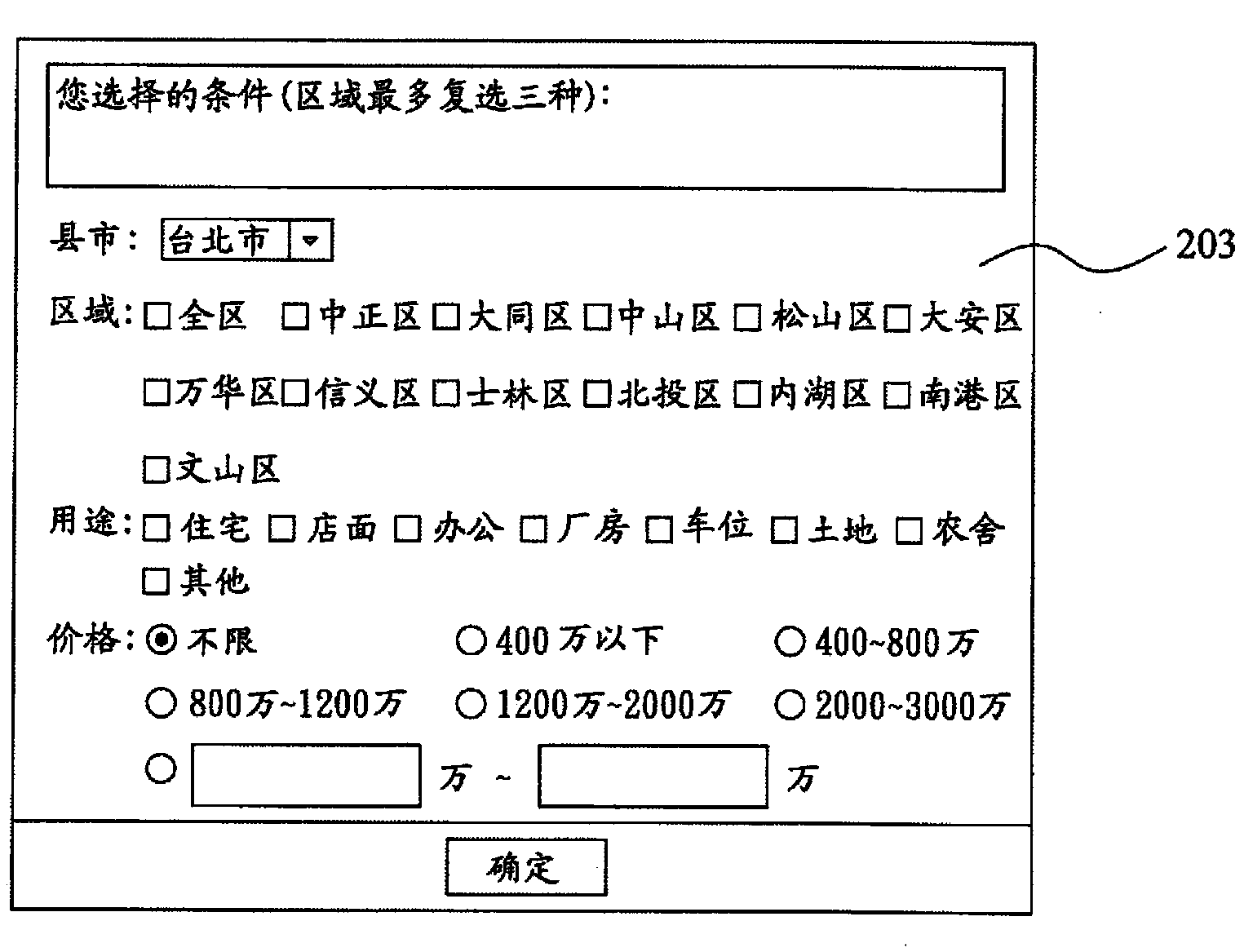

Object renting and selling system with object price fluctuation as display basis

InactiveCN104281967ABuying/selling/leasing transactionsInformation technology support systemTerminal equipmentComputer terminal

The invention provides an object renting and selling system with object price fluctuation as a display basis. The object coverage range includes house buying, housing selling, house renting and surrounding services related to houses. The object renting and selling system comprises a terminal device and a server. The terminal device moves through a map user interface of the terminal device to search for object information and specific facility information. The server is provided with a database. The object information and the specific facility information are stored in the database. When price fluctuation of the object information occurs, the database will carry out price fluctuation mark on the object information correspondingly on the map user interface, and information content will be displayed when a user selects the price fluctuation mark; icon marks corresponding to specific facilities will appear on the map user interface by the database according to the fact whether the user sets the specific facility display information or not, and when the user selects the icon marks of the specific facilities, the information content of the icon marks will be displayed.

Owner:永庆房屋仲介股份有限公司

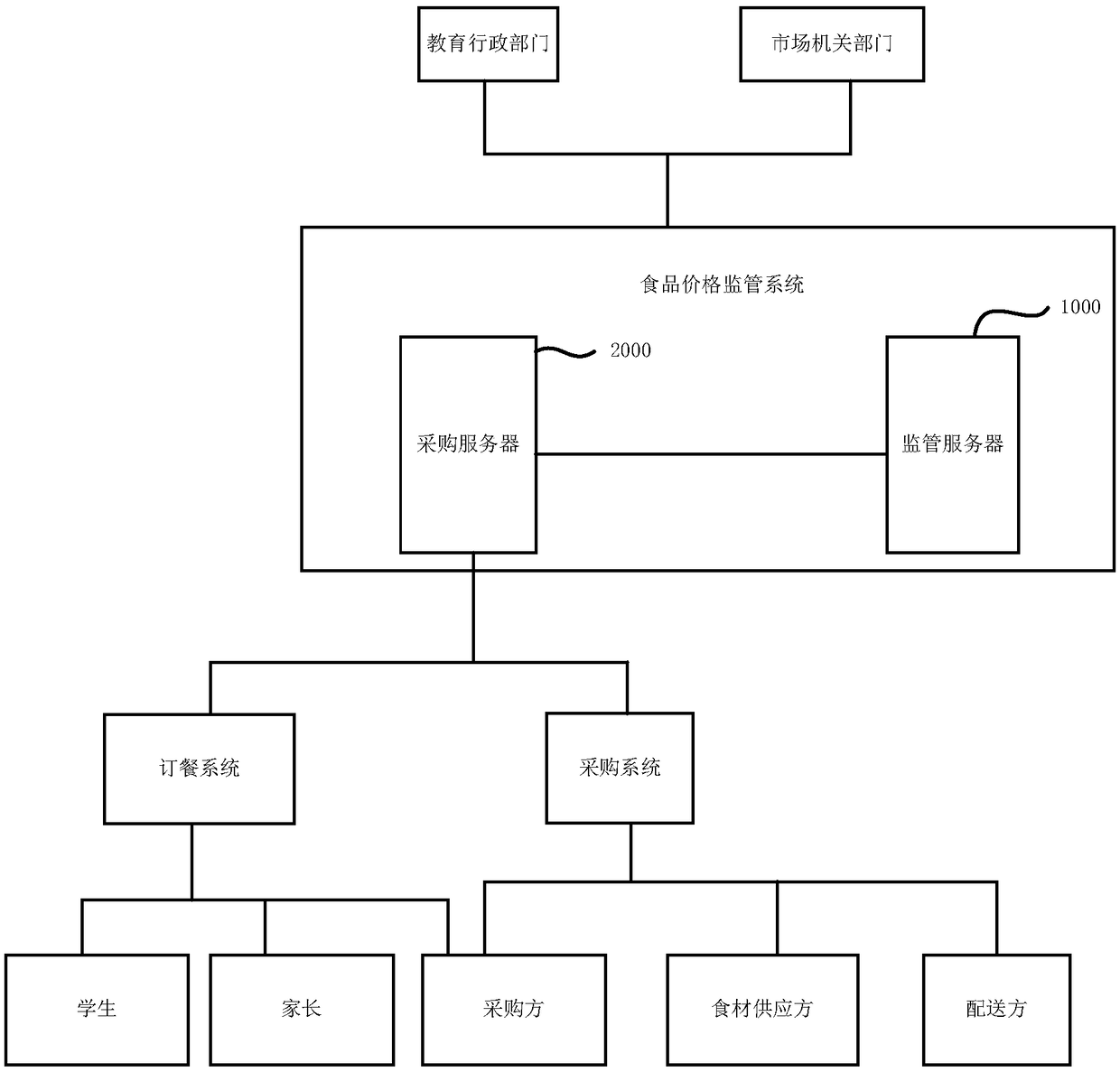

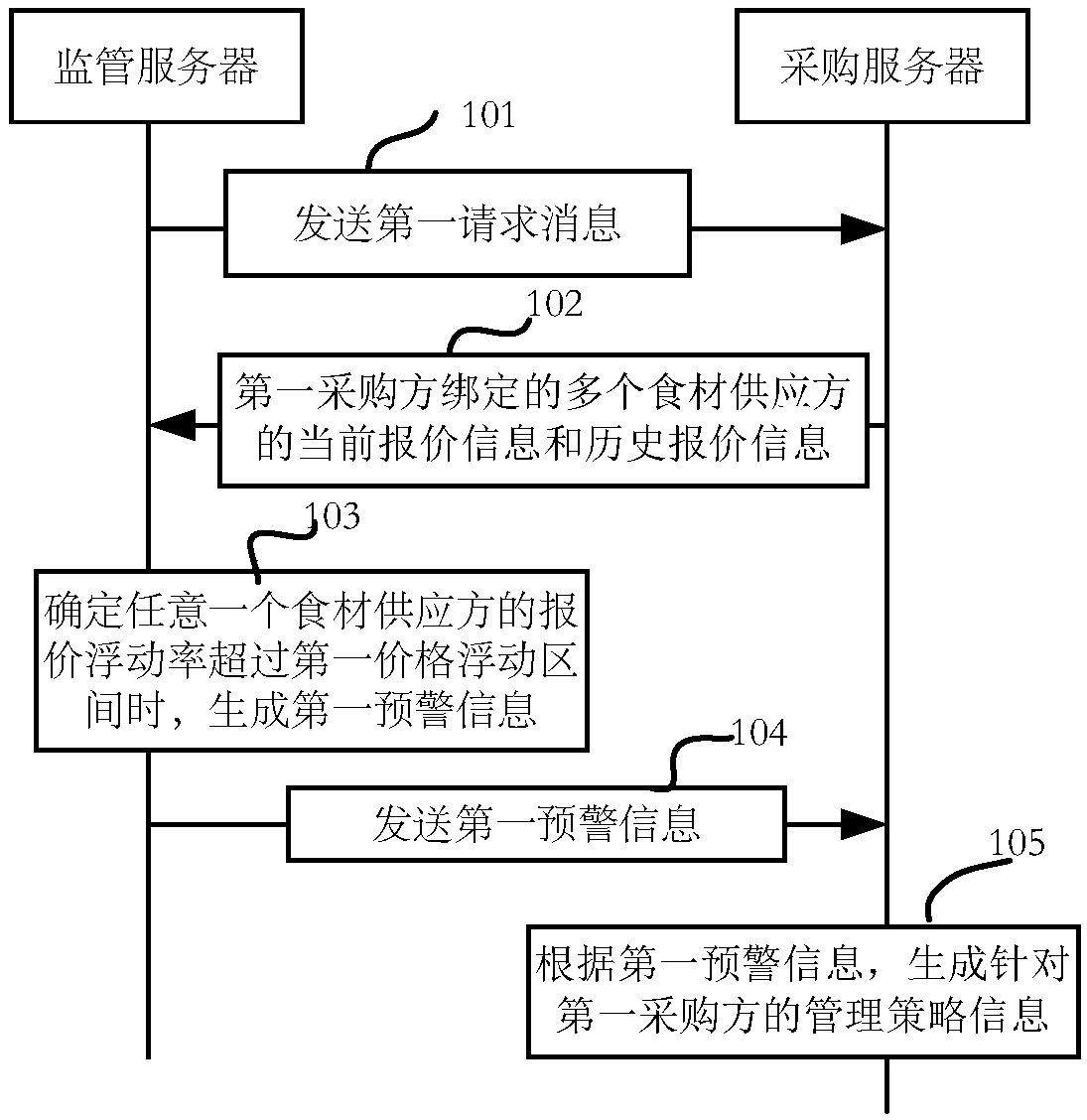

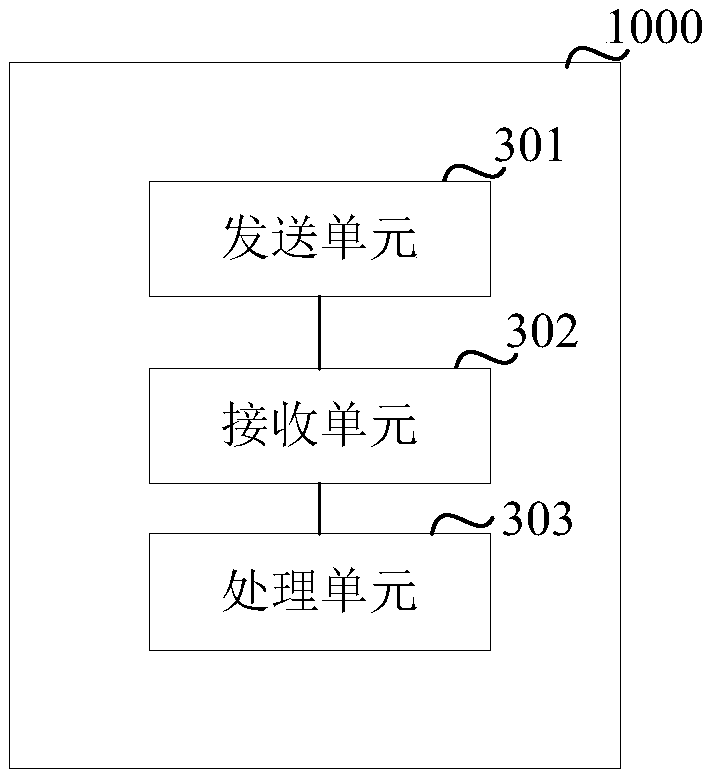

Food price supervision method, device and system

ActiveCN108846689AMarket predictionsBuying/selling/leasing transactionsFood materialPrice fluctuation

The invention provides a food price supervision method, an apparatus and a system. The method comprises the steps: a supervision server sends a first request message to a purchase server, wherein thefirst request message is used for requesting to obtain the current quotation information and the historical quotation information of a plurality of food material suppliers bound to the first purchaser; and when the supervision server determines the quotation floating rate of any one of the food material suppliers exceeds the first price floating range according to the received current quotation information and the historical quotation information fed back by the purchase server, the first warning information is generated and sent, wherein the first warning information is for indicating to thepurchase server that the first purchaser has the risk of purchase price deviation. When the quotation floating or the package price fluctuation exceeds the set standard, warning is given to the purchase server and the purchase server puts forward reasonable suggestions to adjust the package price or the purchase-supply relationship or the proportion of the food materials in the package so that thequotation fluctuation and the package price fluctuation can be controlled within a reasonable range.

Owner:河南金凤电子科技有限公司

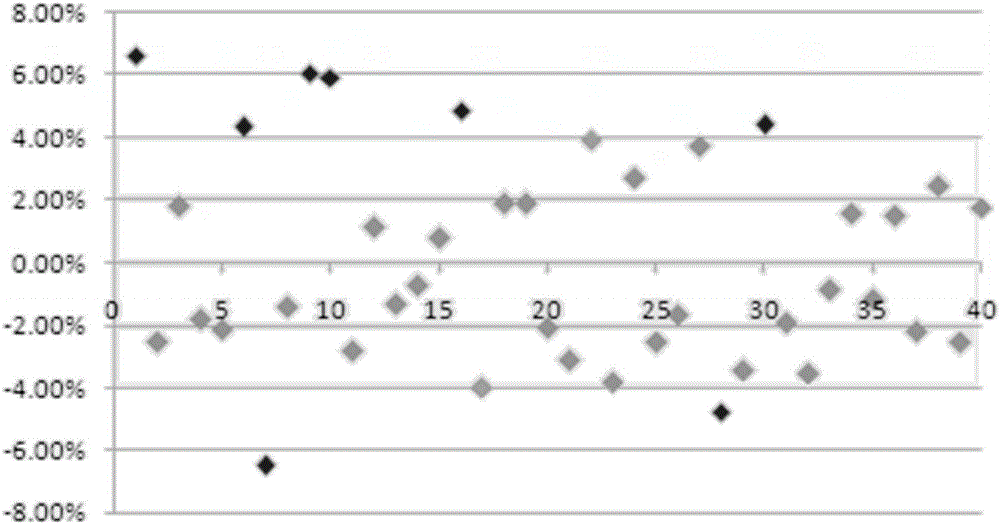

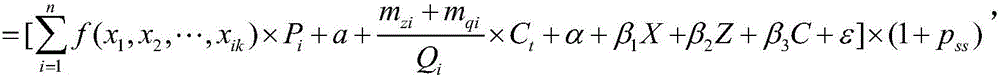

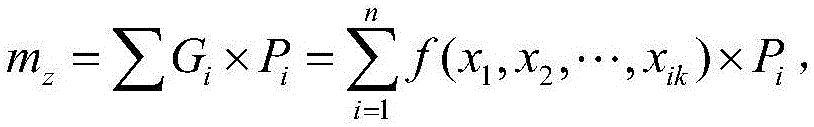

Transformer price evaluation method based on equipment composition

The invention relates to a transformer price evaluation method based on equipment composition. The method comprises the following steps: estimating the costs of transformers; performing multiple regression on the quantity demanded, concentration ratio and bidding strategy data of the transformers, judging the goodness-of-fit through correlation indexes, index goodness-of-fit and determination indexes, and acquiring a functional relationship among profit, transformer demand, concentration ratio and bidding strategy through significance testing; sequencing dispersion degrees of random price components of a certain type of transformers at a price historical data point, and eliminating individual sample points with high dispersion degrees, so as to obtain a price fluctuation interval pss and further obtain a transformer price evaluation model; evaluating transformer prices according to the transformer price evaluation model, so as to reduce the equipment procurement cost and engineering investment risk.

Owner:STATE GRID CORP OF CHINA +1

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com