Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

194results about How to "Potential risk" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

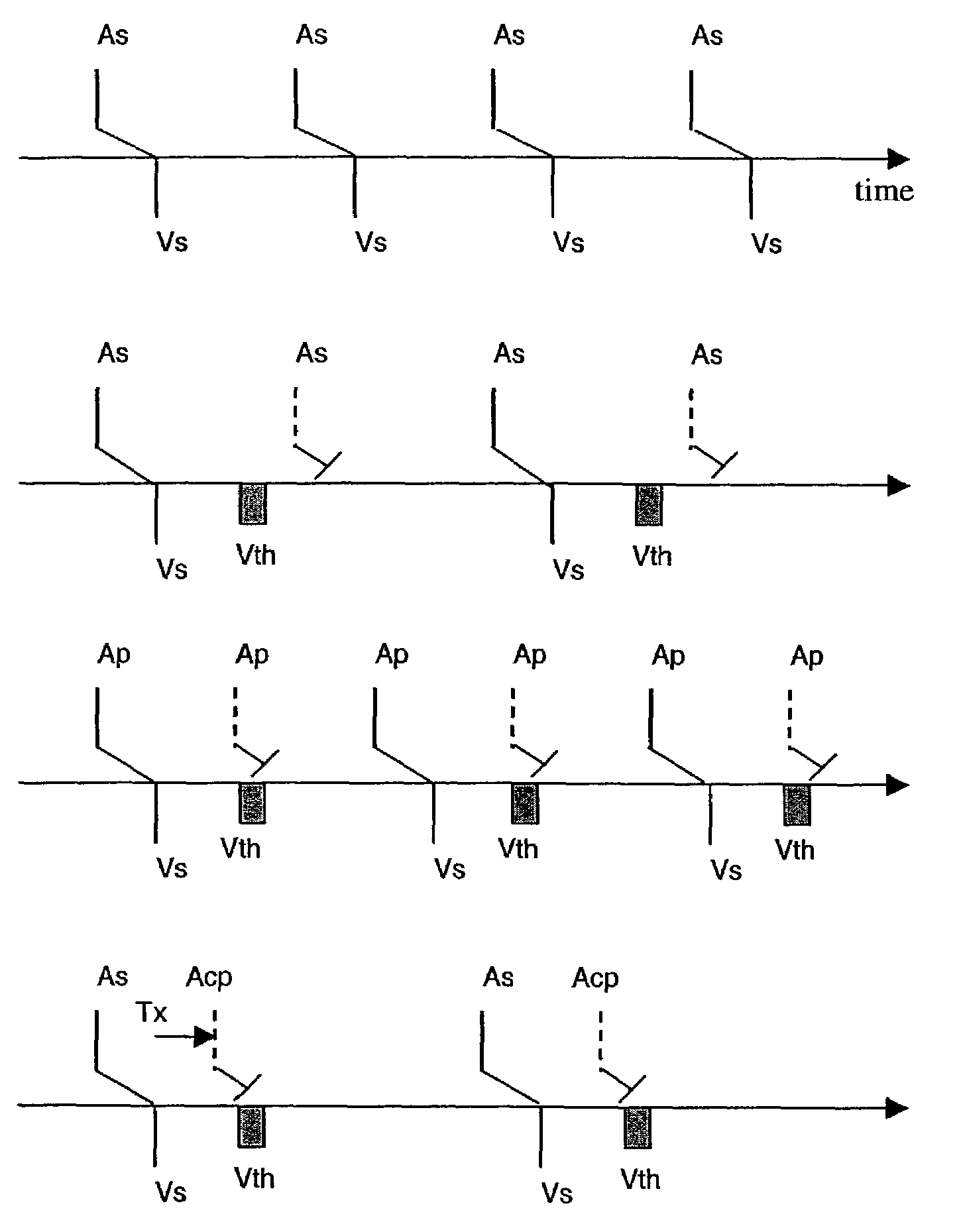

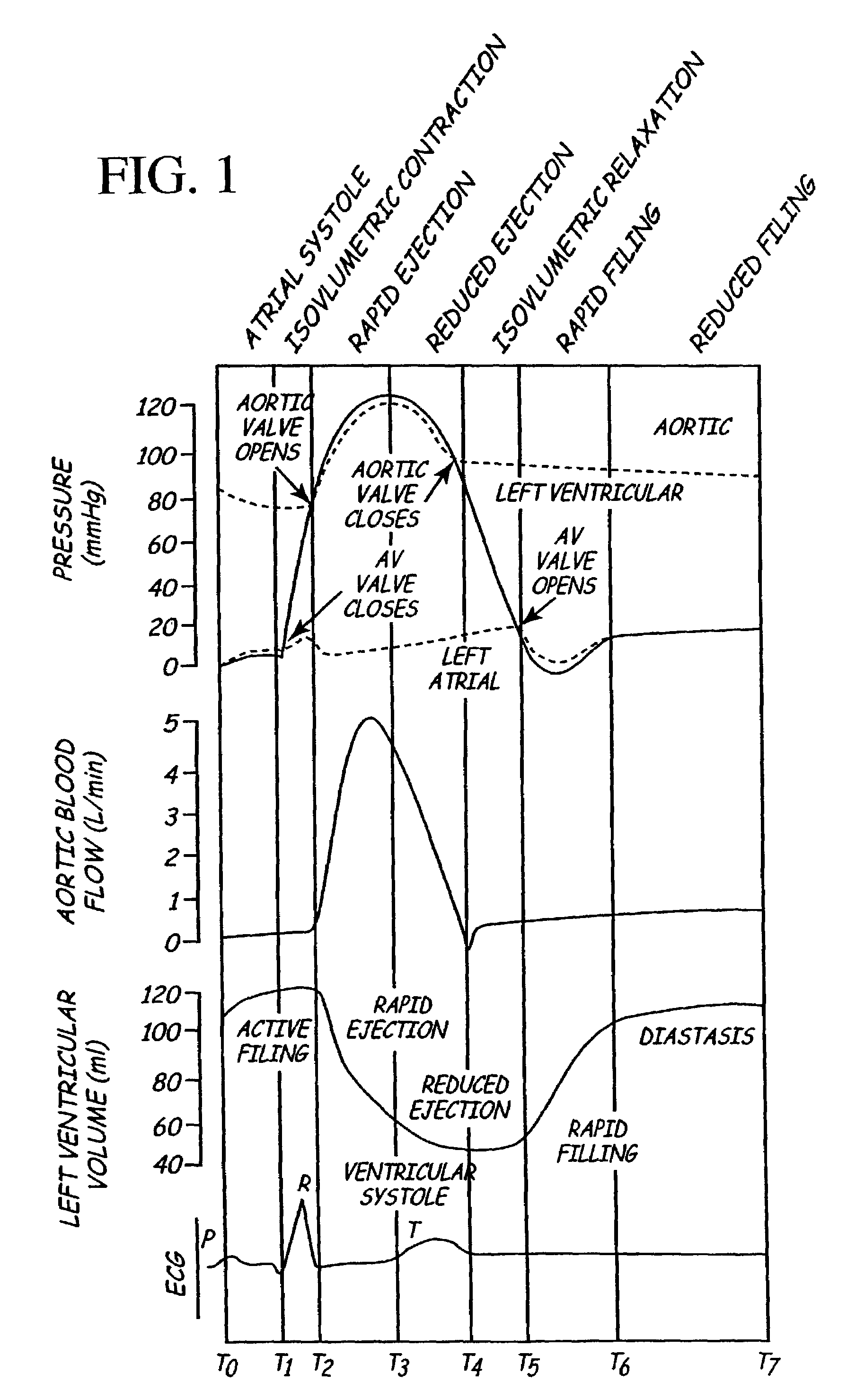

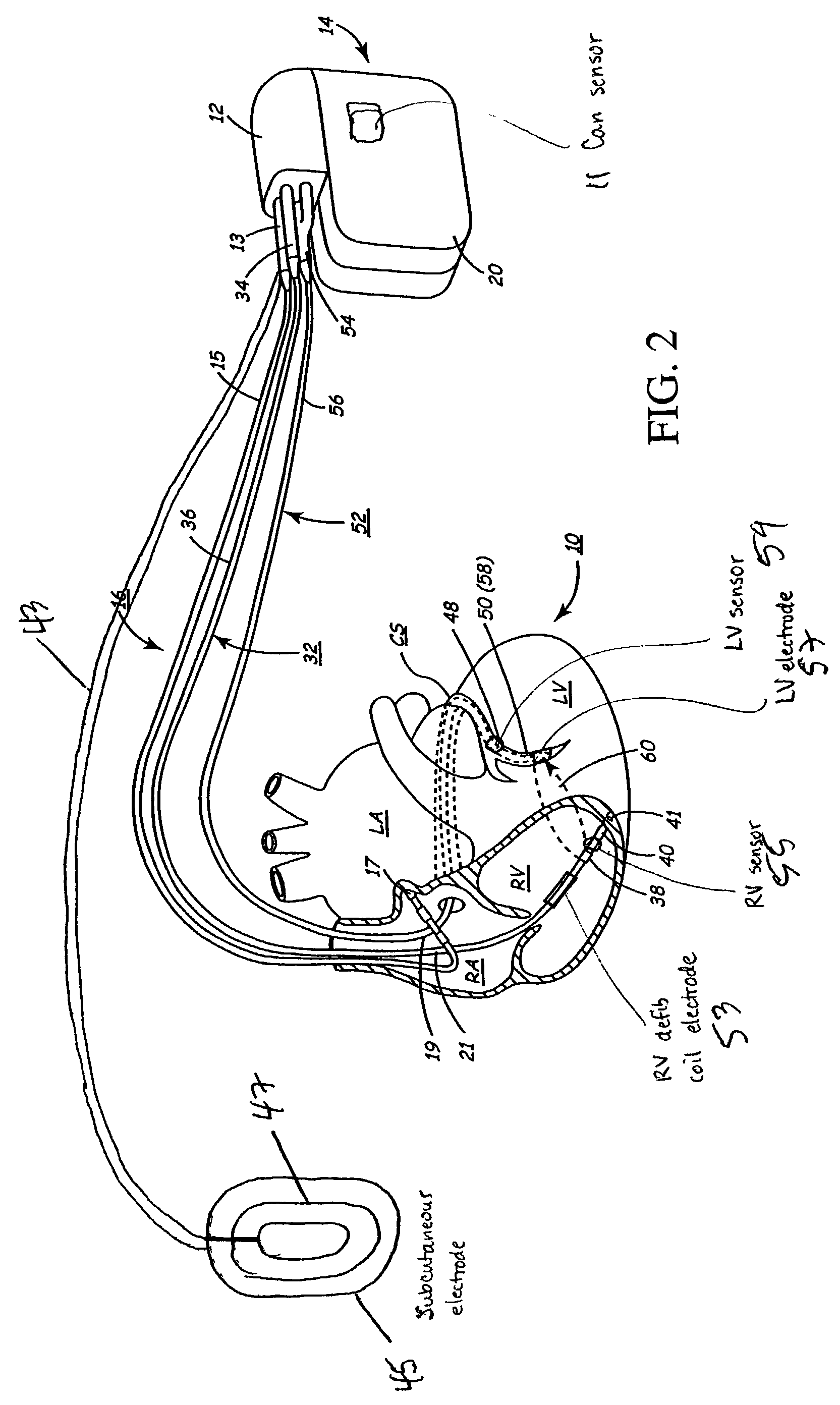

Implantable medical device for treating cardiac mechanical dysfunction by electrical stimulation

InactiveUS7096064B2Improve toleranceExtension of timeHeart defibrillatorsHeart stimulatorsCardiac dysfunctionElectrical stimulations

The disclosure provides methods and apparatus of particular benefit for patients suffering heart failure including cardiac dysfunction, chronic HF, and the like and all variants thereof. According to the disclosure monitoring and therapy delivery for a wide variety of acute and chronic cardiac dysfunctions are described and depicted. Various forms of paired or coupled pacing therapy delivery provided alone or in combination with neurostimulation therapy delivered by both implantable and external apparatus, including defibrillation therapy are also provided herein.

Owner:MEDTRONIC INC

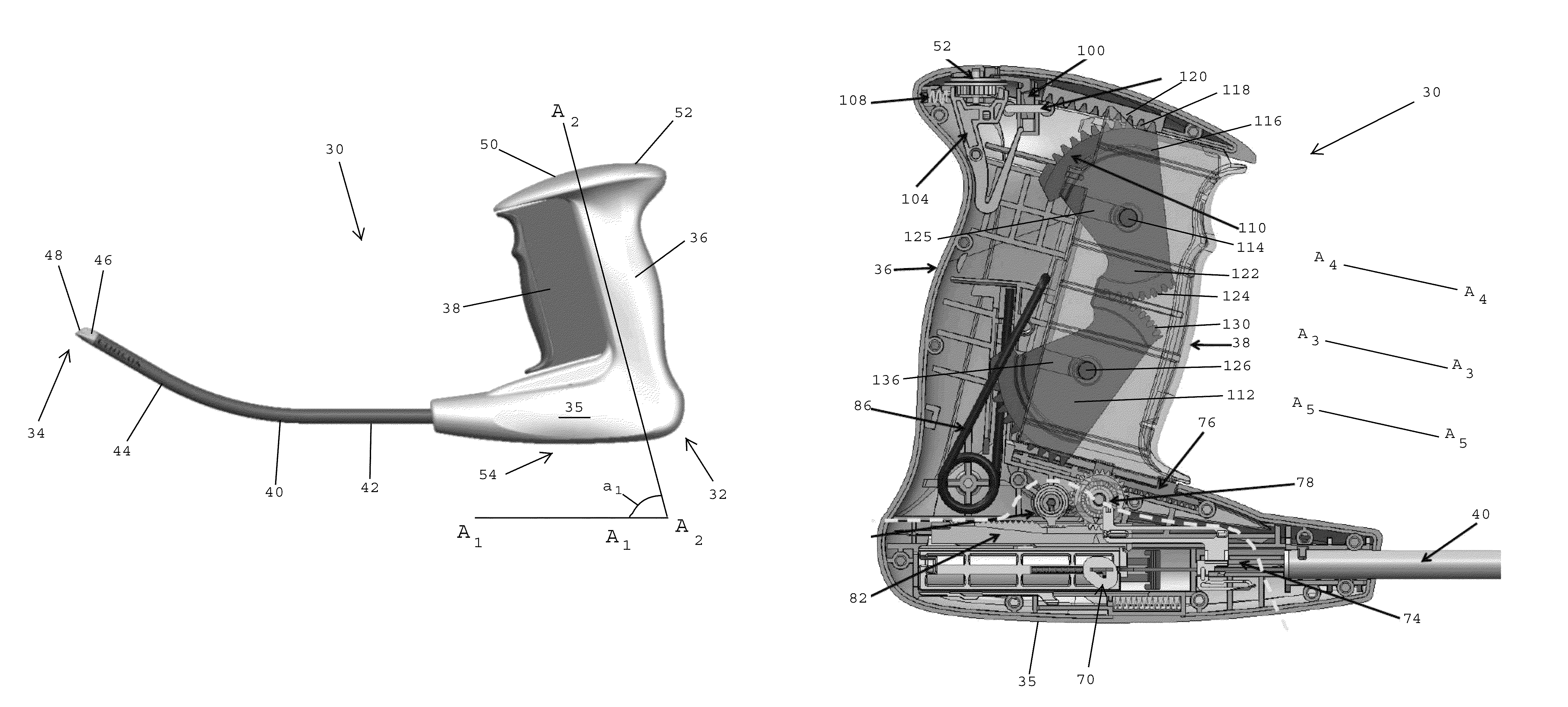

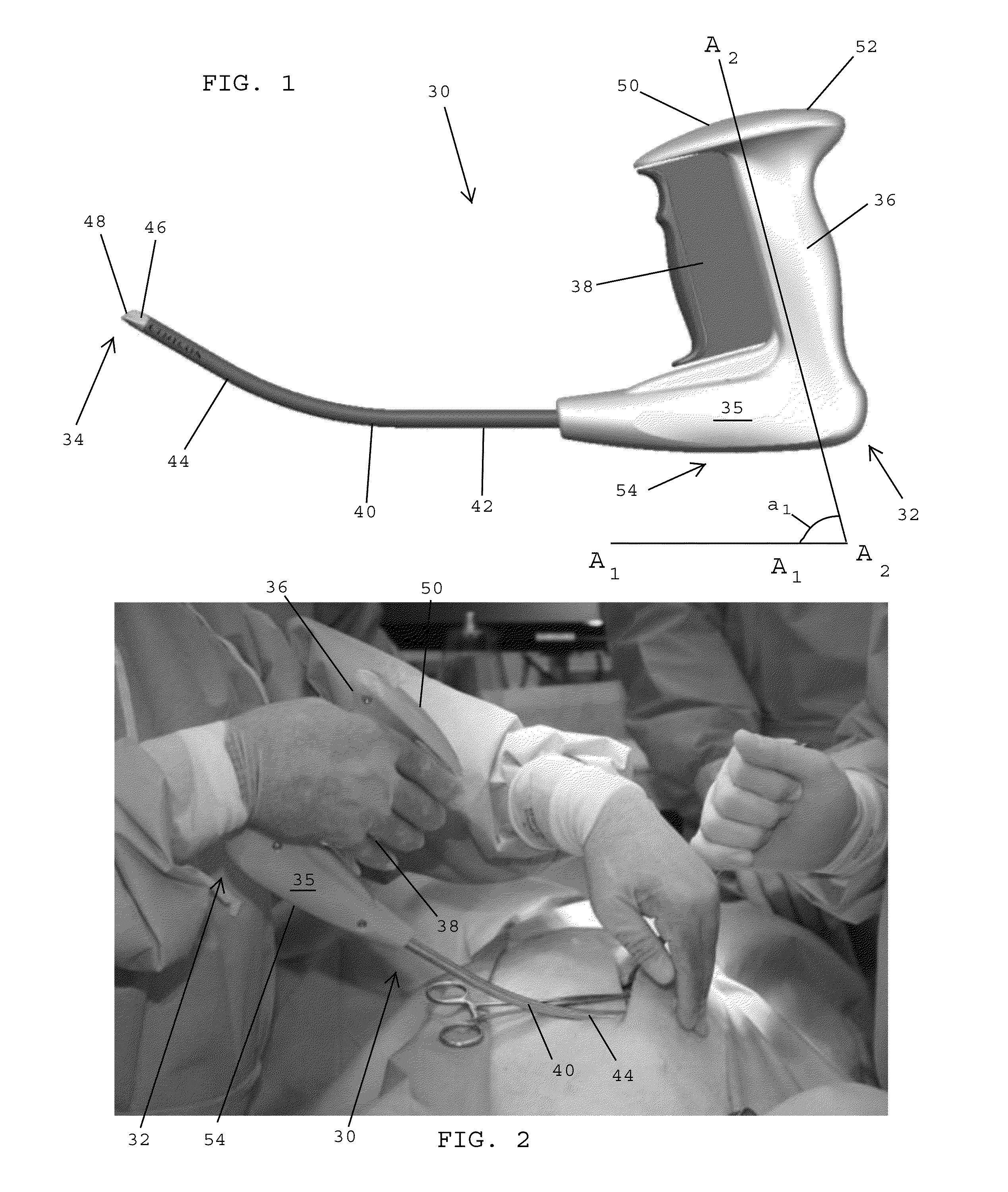

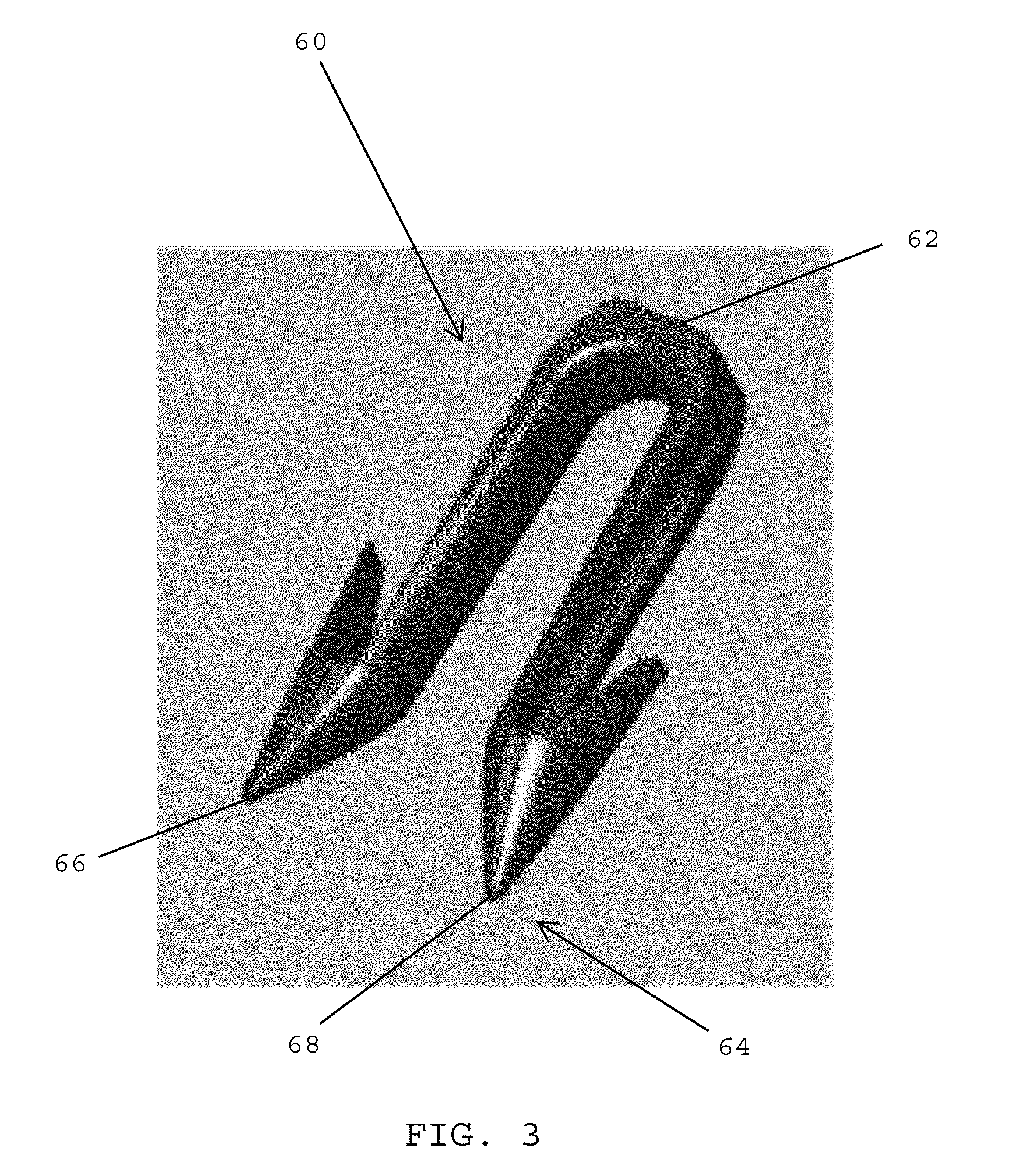

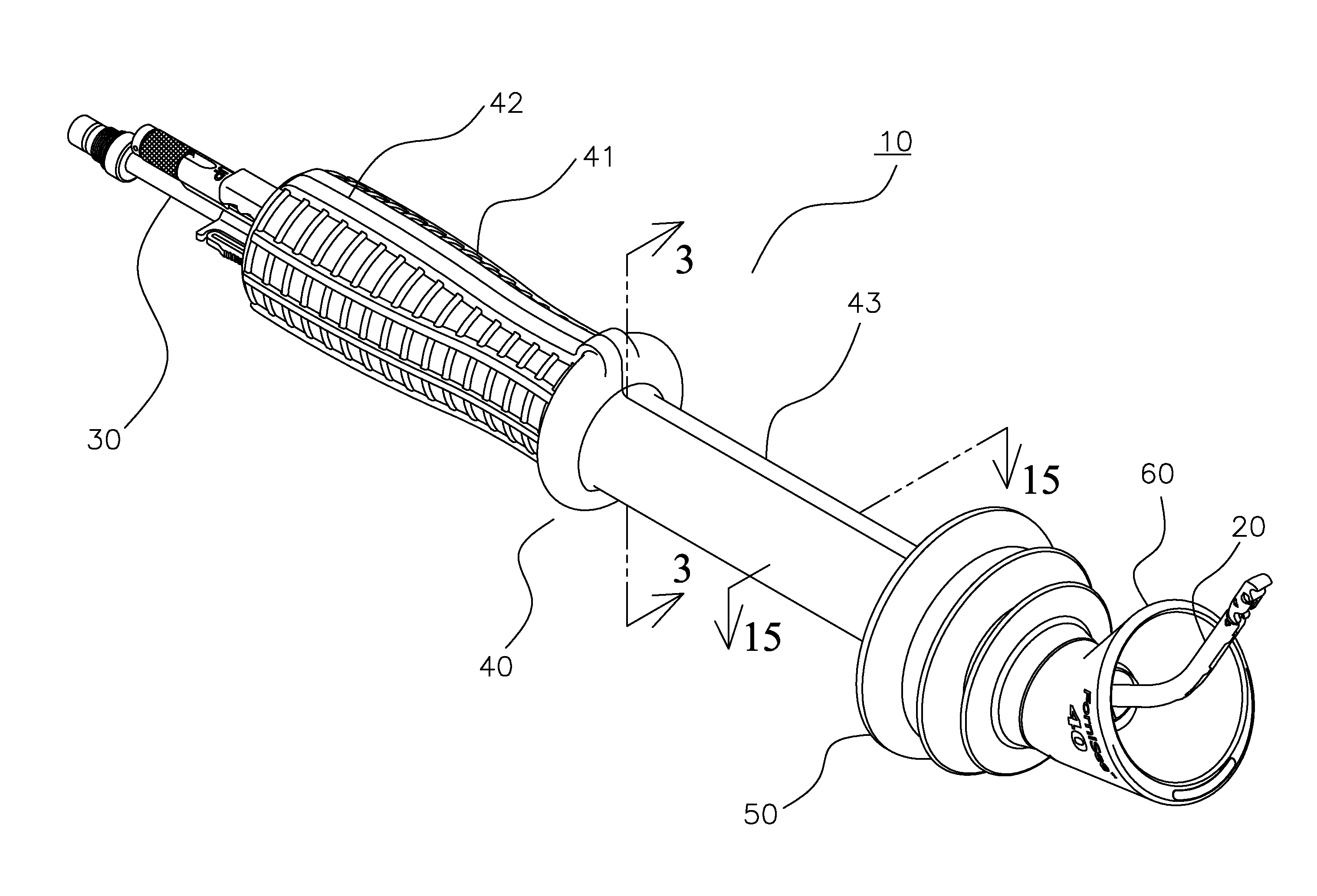

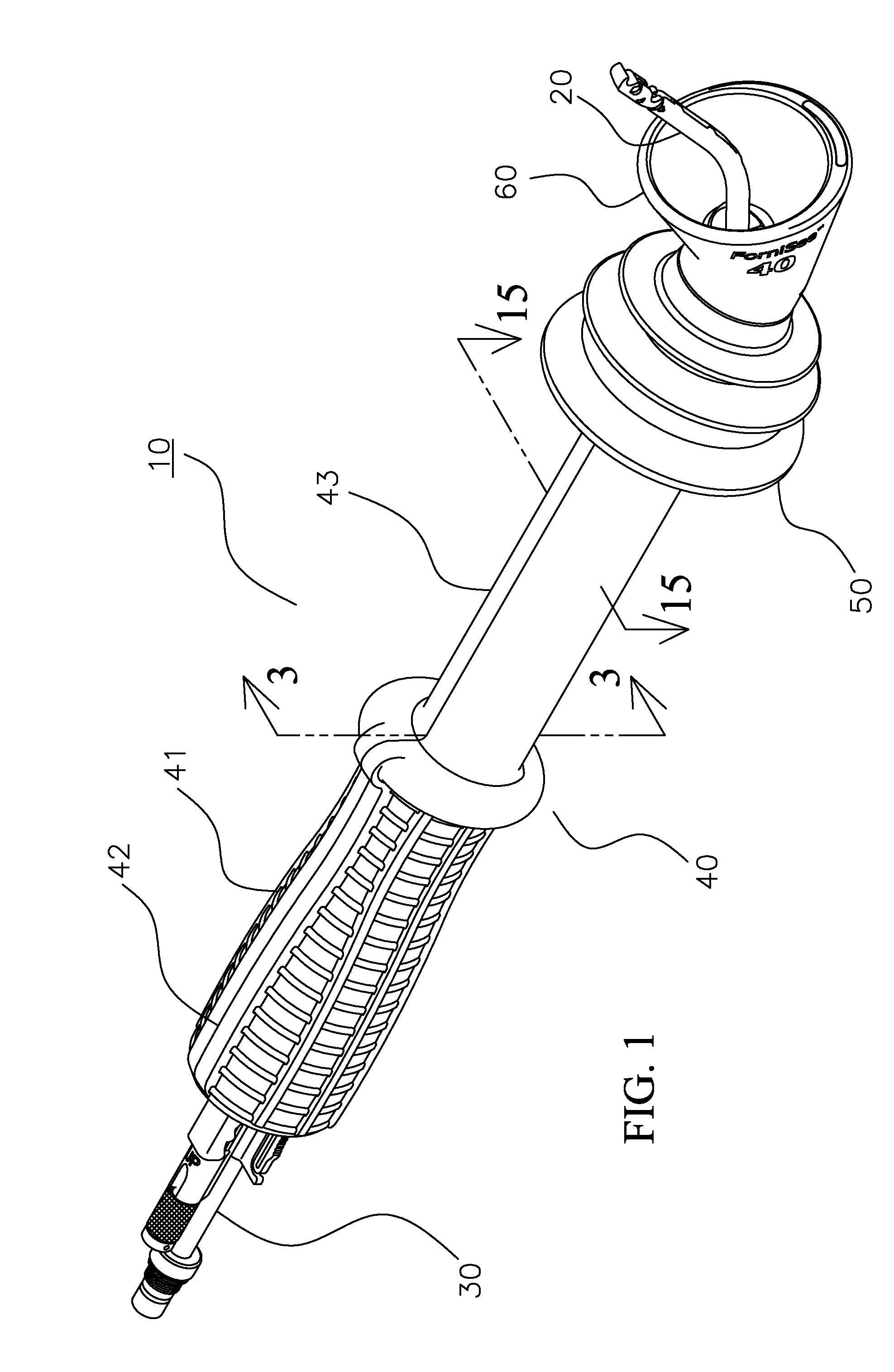

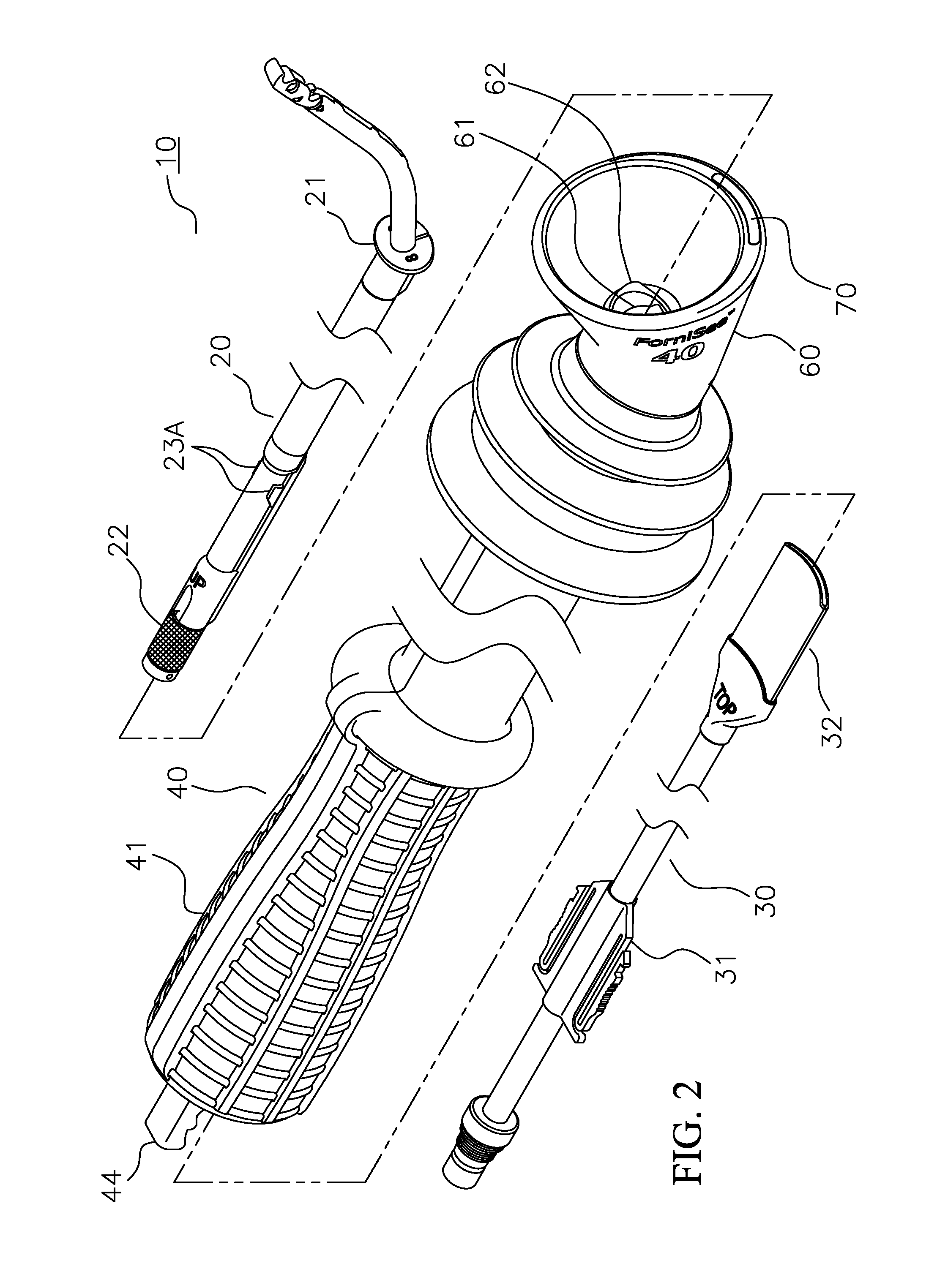

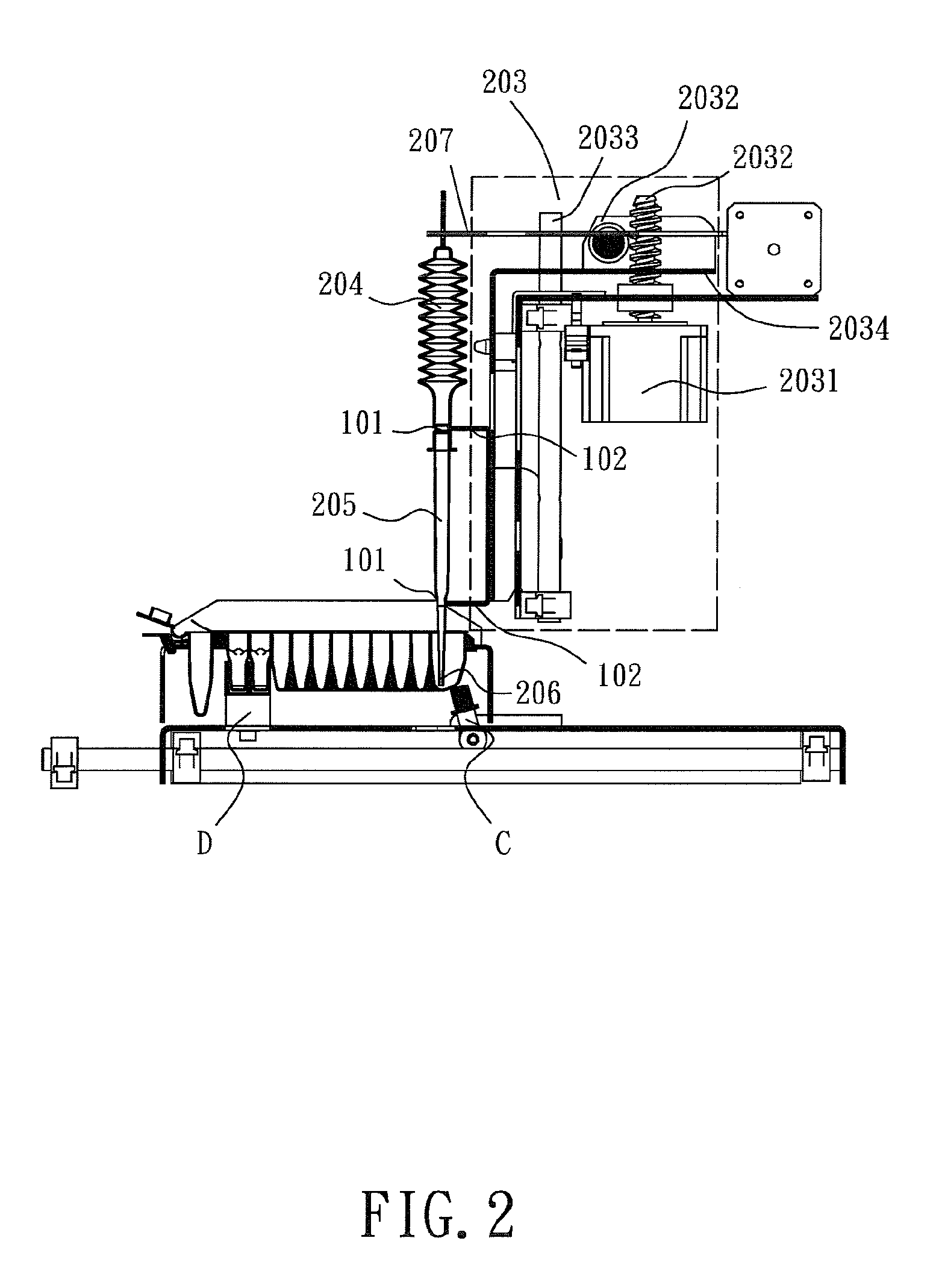

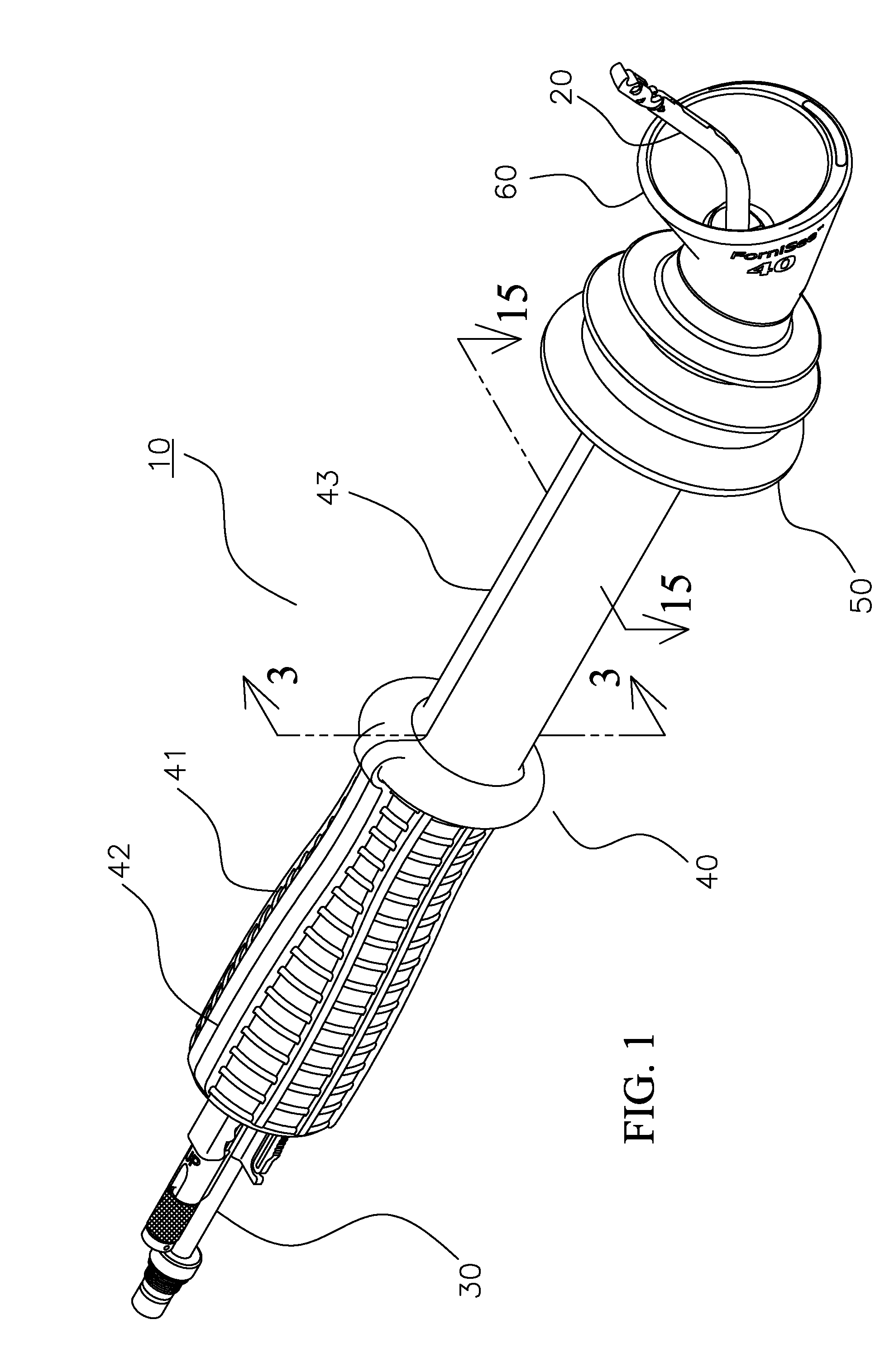

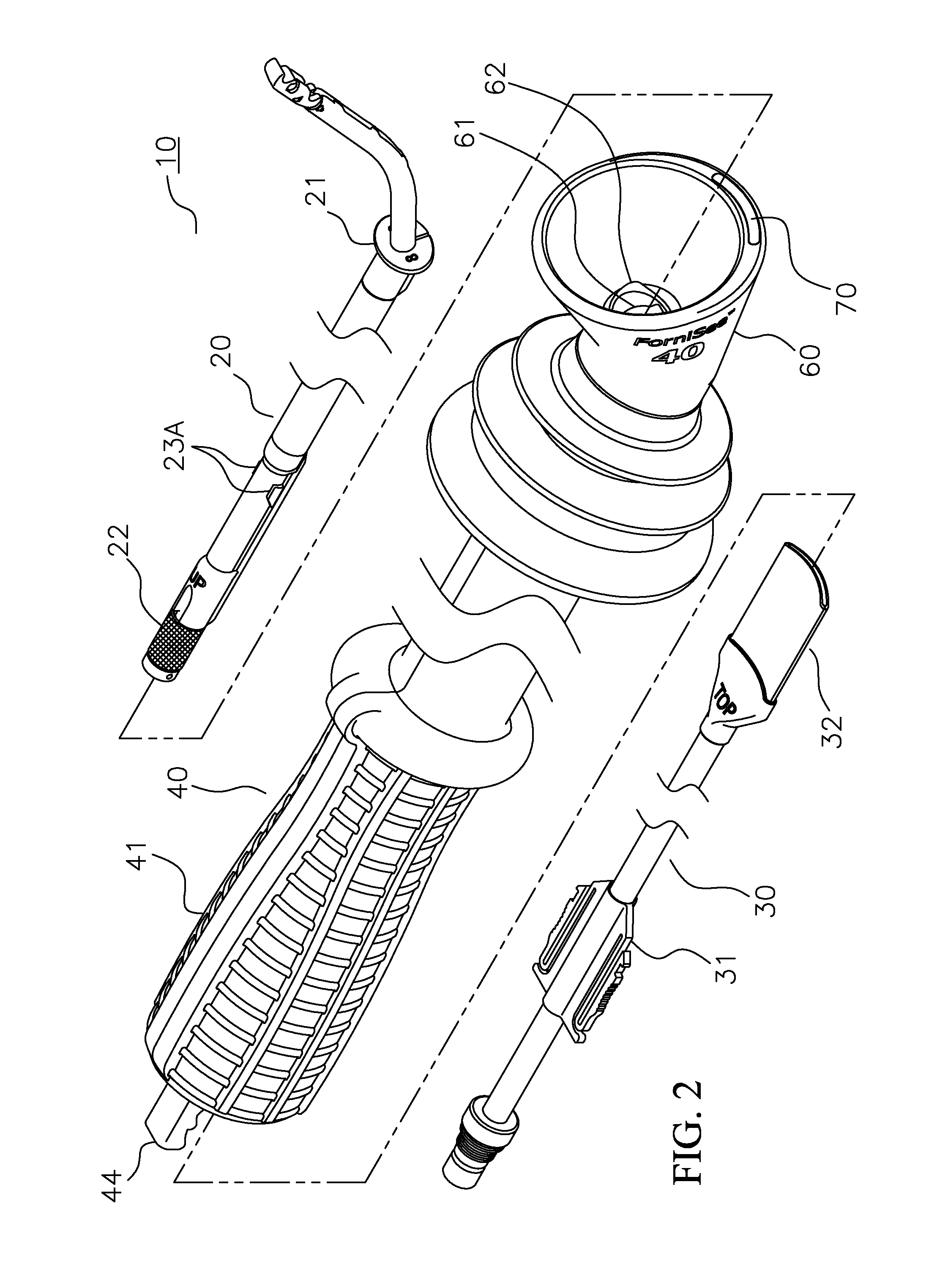

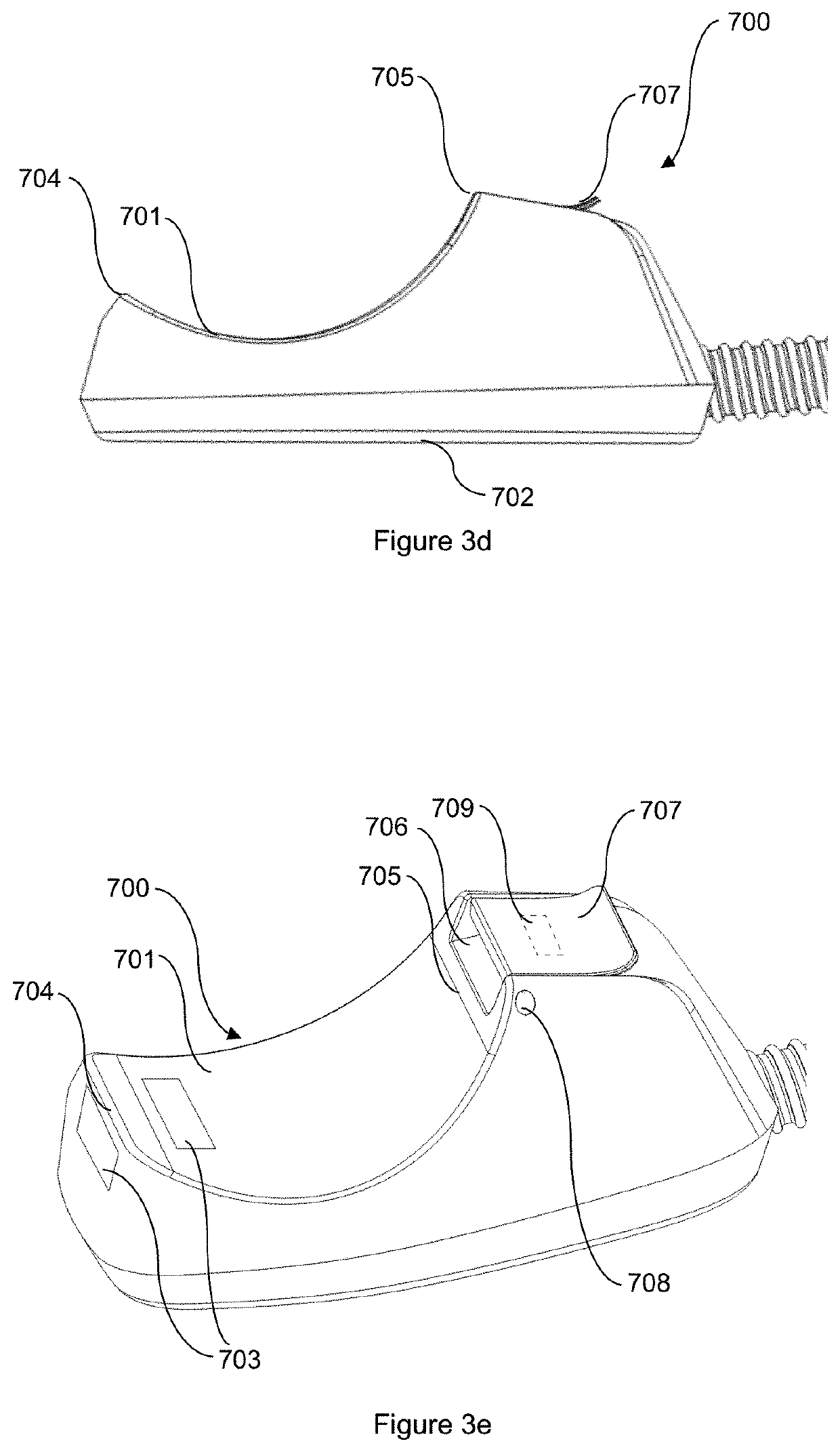

Applicator instruments for dispensing surgical fasteners during open repair procedures

ActiveUS8518055B1Potential riskFacilitate incremental feedingDiagnosticsSurgical staplesAcute angleSurgical department

An applicator instrument for dispensing surgical fasteners includes a housing defining a bottom of the applicator instrument, a firing system disposed in the housing and being moveable in distal and proximal directions along a first axis, a handle extending upwardly from the housing along a second axis that defines an acute angle with the first axis, the handle having an upper end that defines a top of the applicator instrument, and a trigger mounted on the handle for actuating the firing system. The applicator instrument includes an elongated shaft extending from the housing, the elongated shaft having a proximal section that extends along the first axis and a distal section that is oriented at an angle relative to the proximal section for extending upwardly toward the top of the application instrument. A distal end cap has a proximally sloping distal face and a dispensing window for dispensing surgical fasteners.

Owner:CILAG GMBH INT

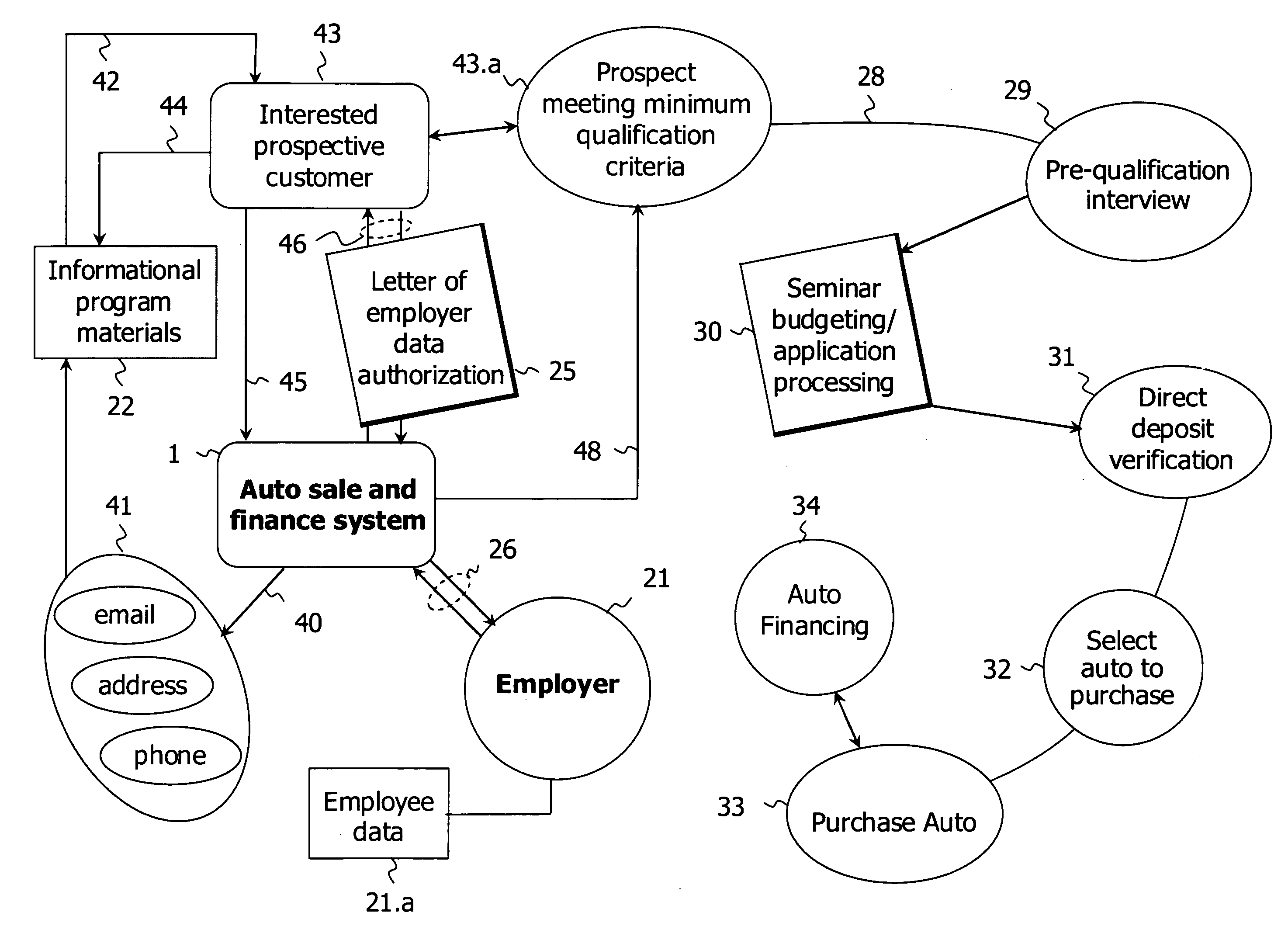

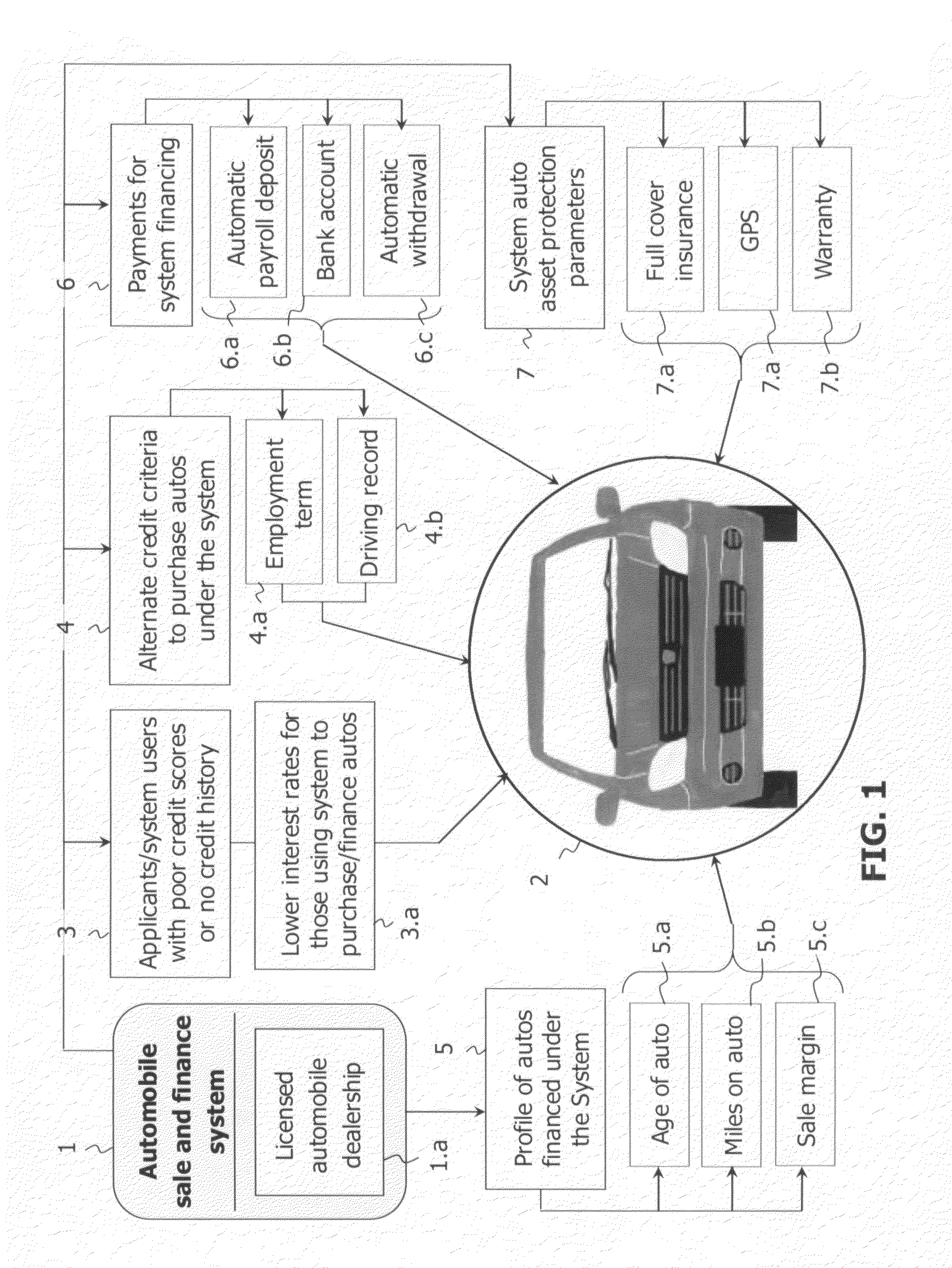

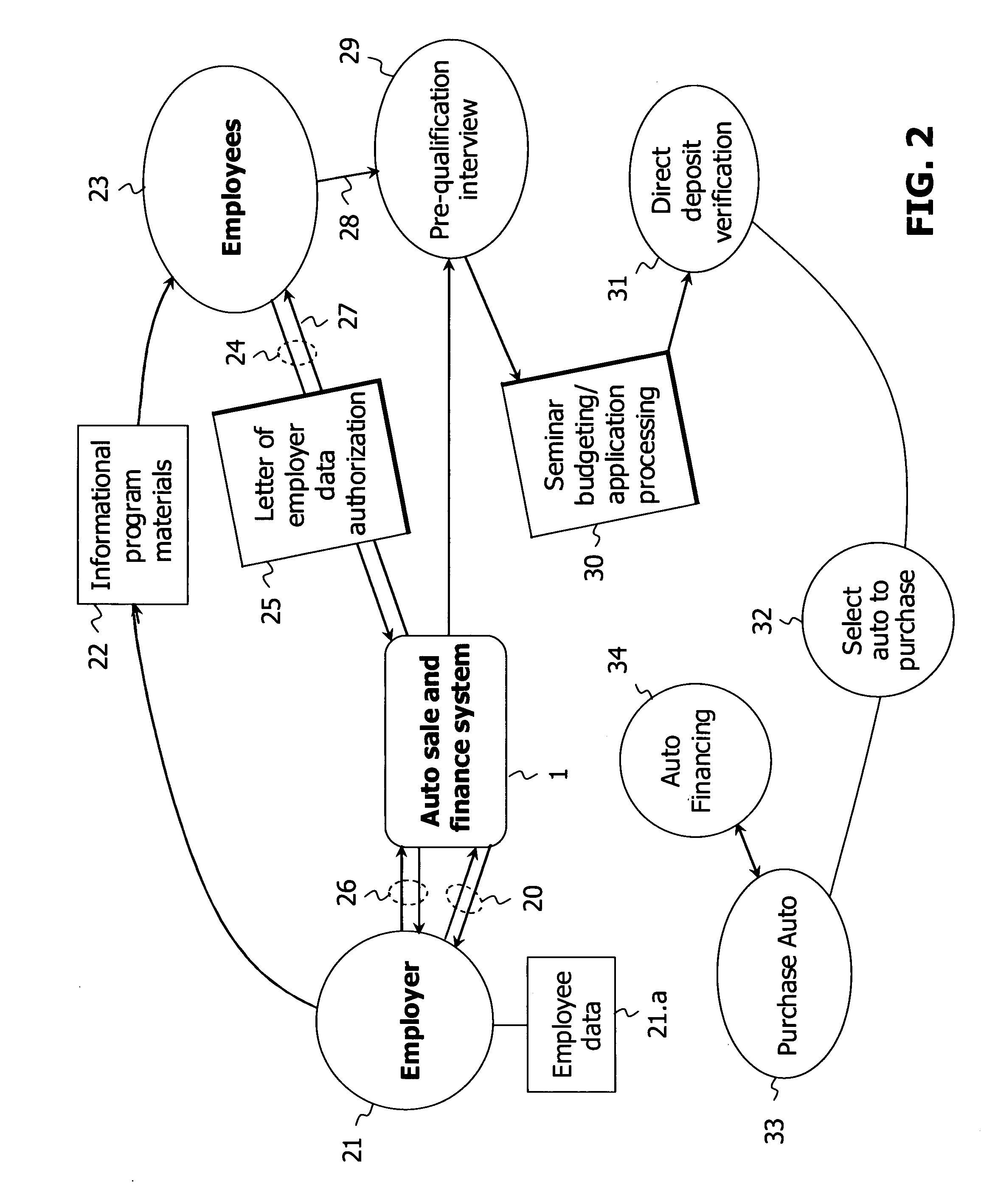

Sub-prime automobile sale and finance system

InactiveUS20070288271A1Raise interest ratesHigh riskFinancePosition fixationSystem structureProgram planning

A system to provide automobile financing to individuals with relatively lower credit scores or ratings, or no credit rating, due to lack of credit or lending purchases, that would otherwise only qualify for sub-prime, higher interest loans. Due to the overall system structure, lower rate interest loans can be extended to participants. The system utilizes the auto financing loan applicant's term of employment and / or other employment performance data as the principal credit criteria to qualify the creditworthiness of an applicant versus the applicant's credit score or credit rating. Applicant's driving records are also reviewed as system automobile loan approval credit criteria. Loan applicants provide employment related information and execute a letter of authorization providing the system with authority / rights to contact the applicant's employer to verify said employment information. In order to provide participants with lower interest rates than would otherwise be available through conventional channels, automobiles financed under the system must meet minimum profile criteria, including the year of the auto, the mileage, retail value relative to the wholesale value, and autos financed under the system are covered by extended warranties and have GPS systems installed for asset protection purposes. In utilizing employment term as the principal creditworthiness criteria, the system can to be offered through employers as an employee loyalty reward program.

Owner:KLINKHAMMER KIRK WILLIAM

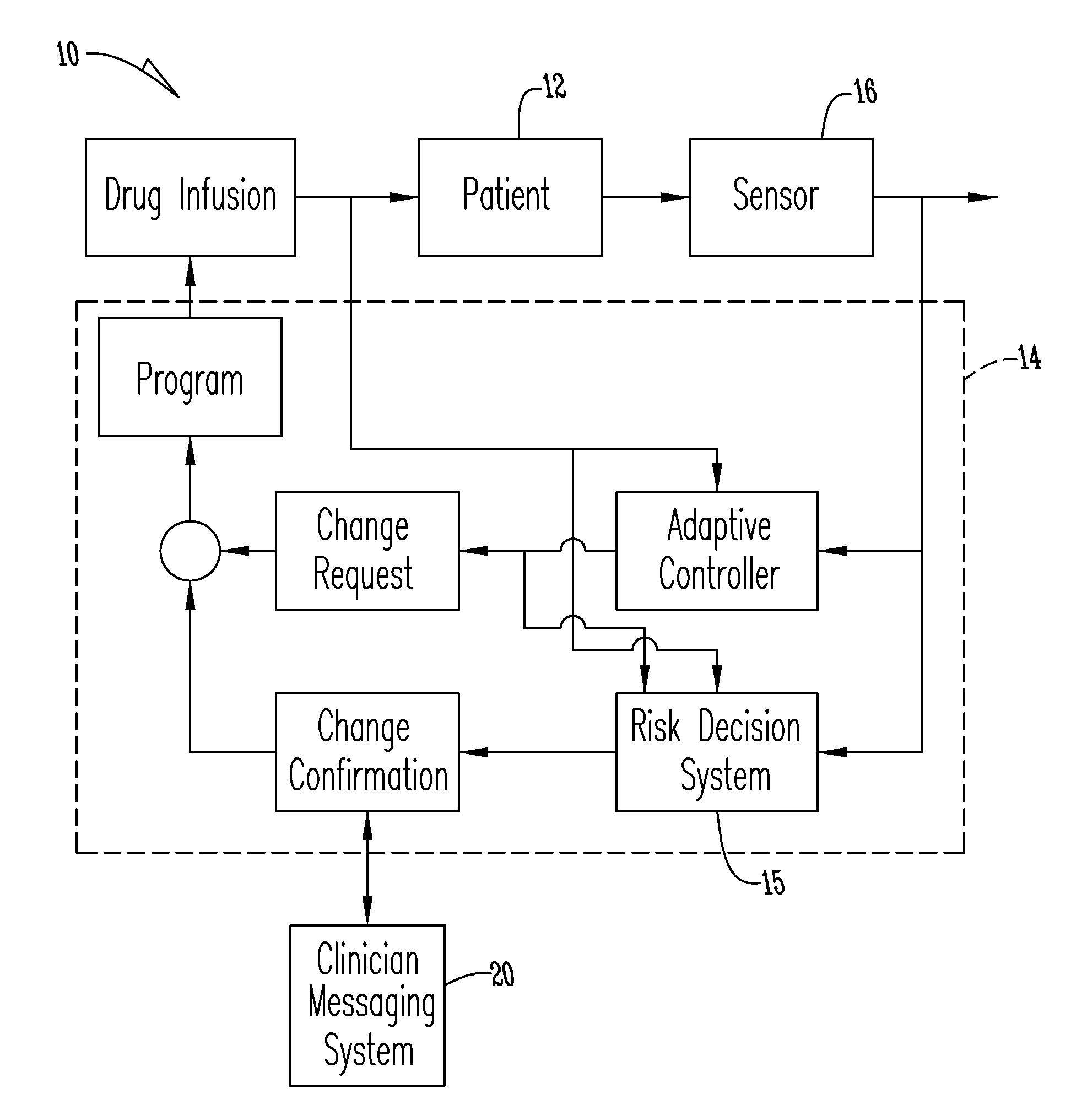

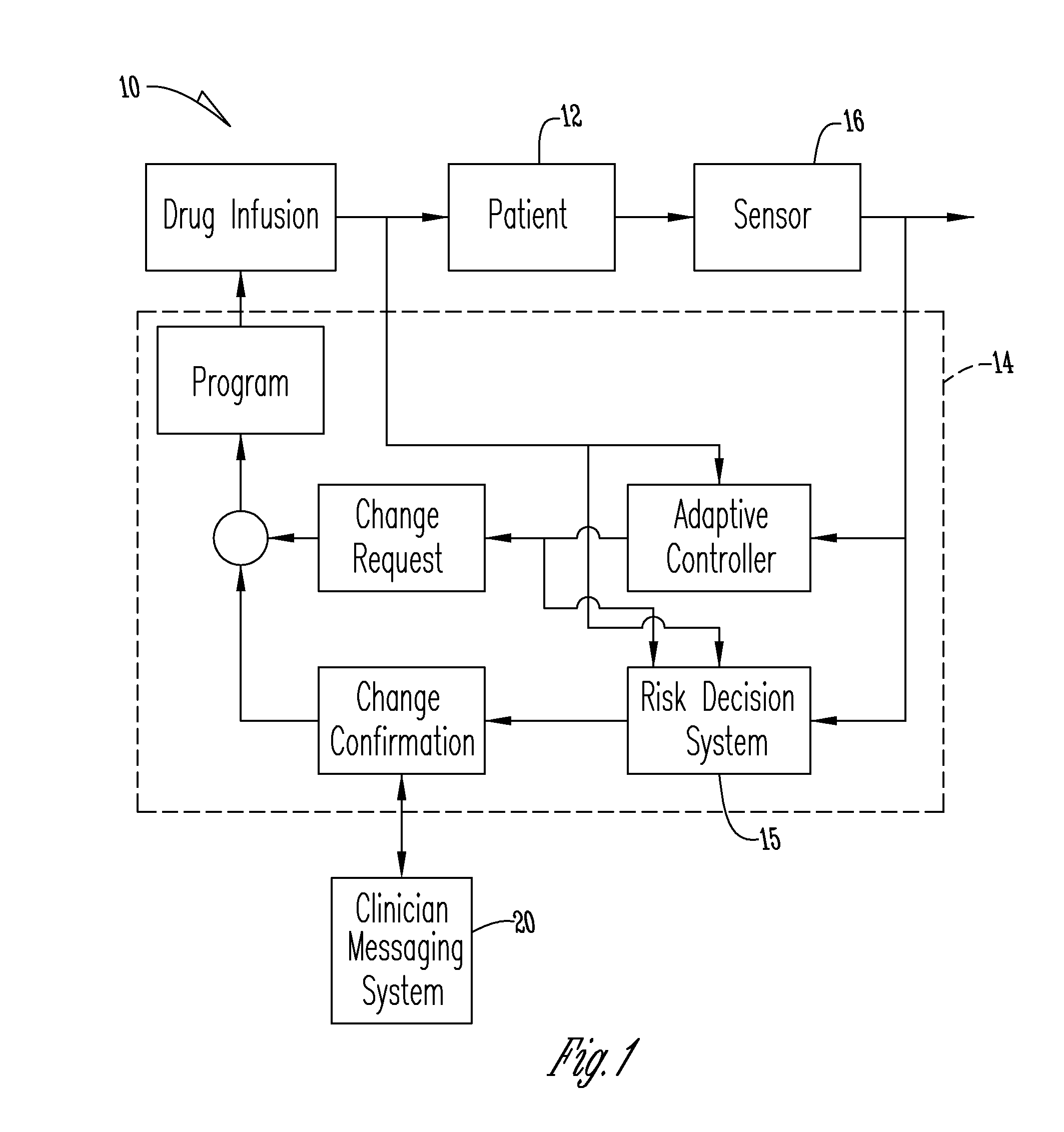

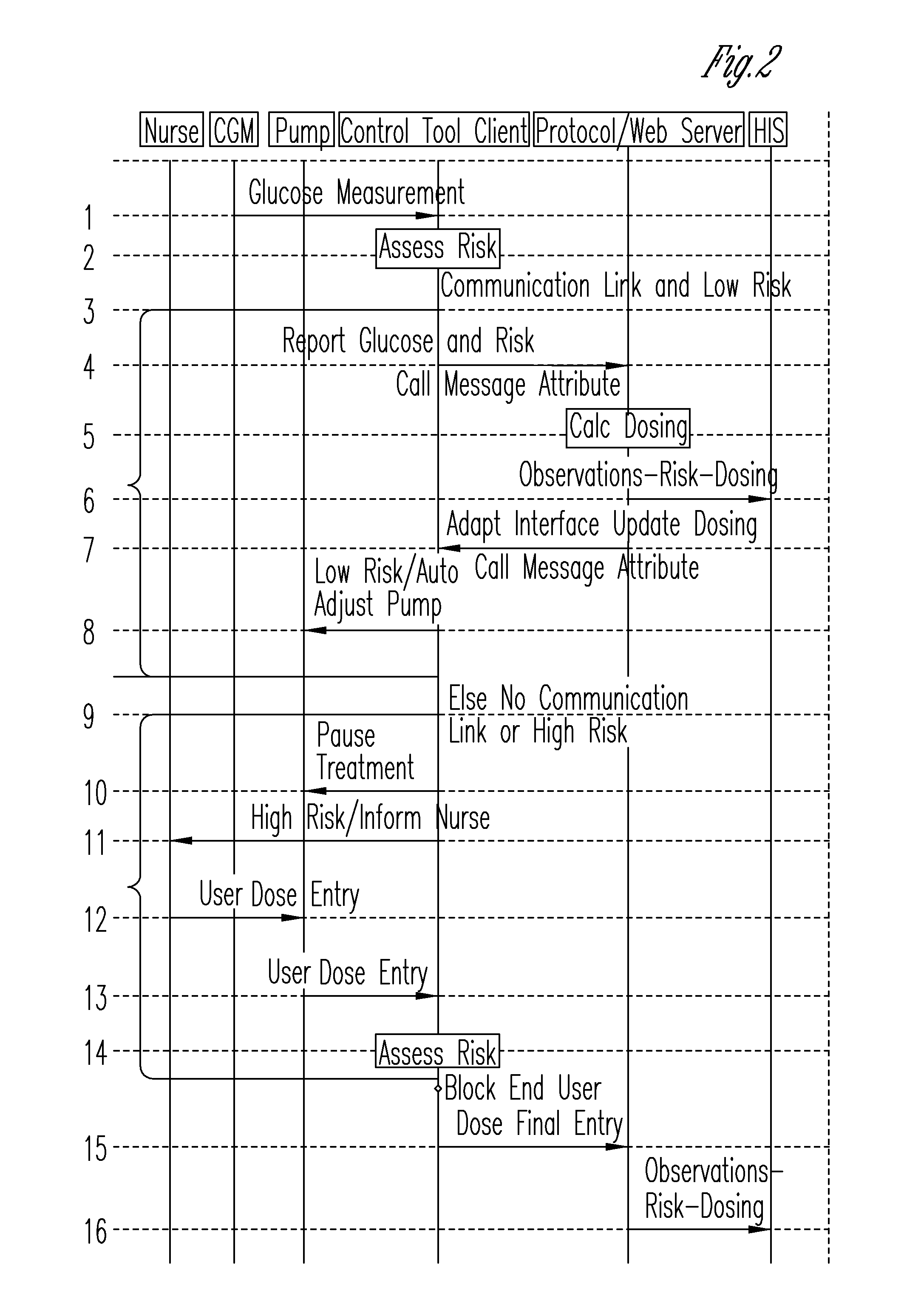

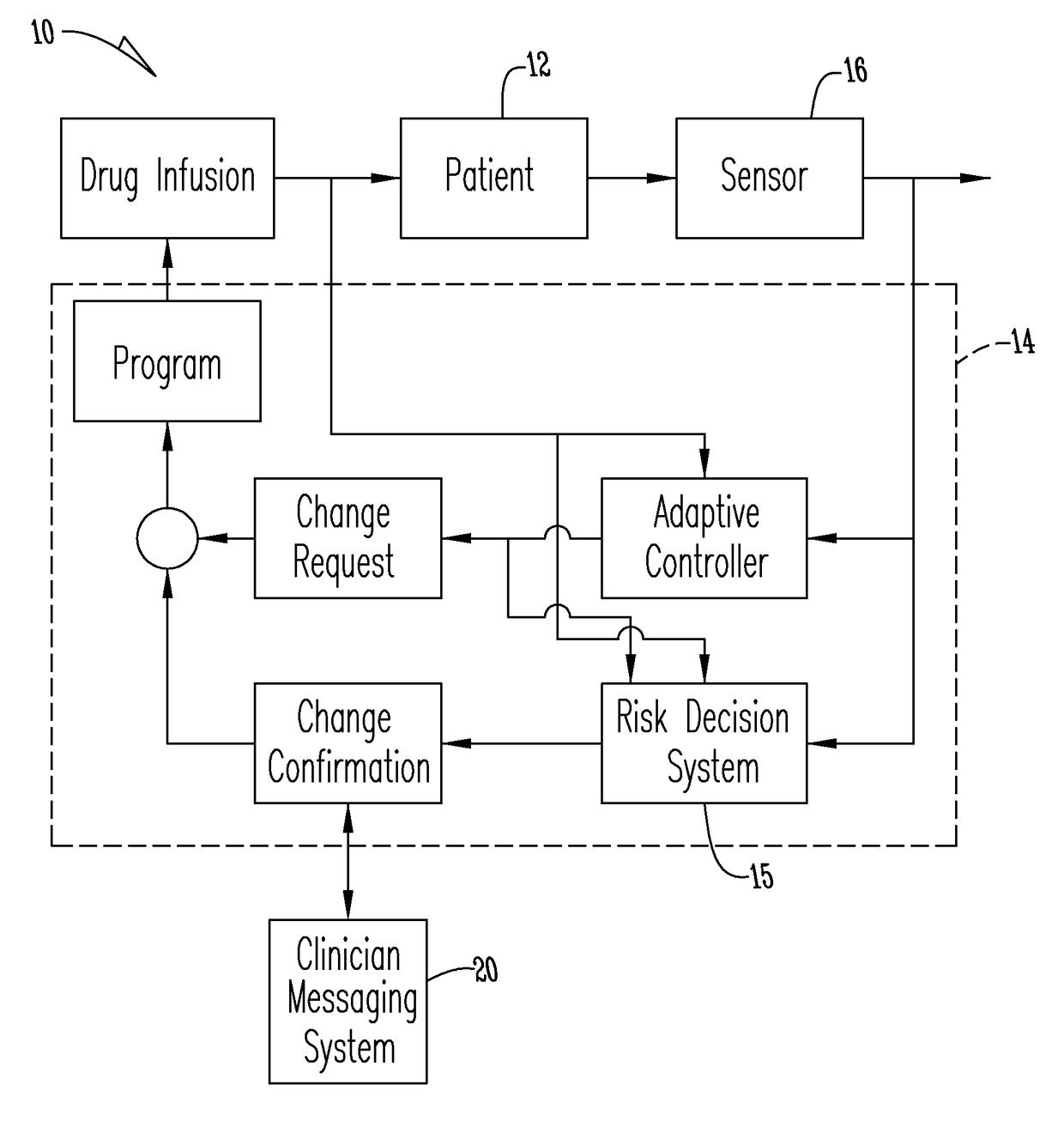

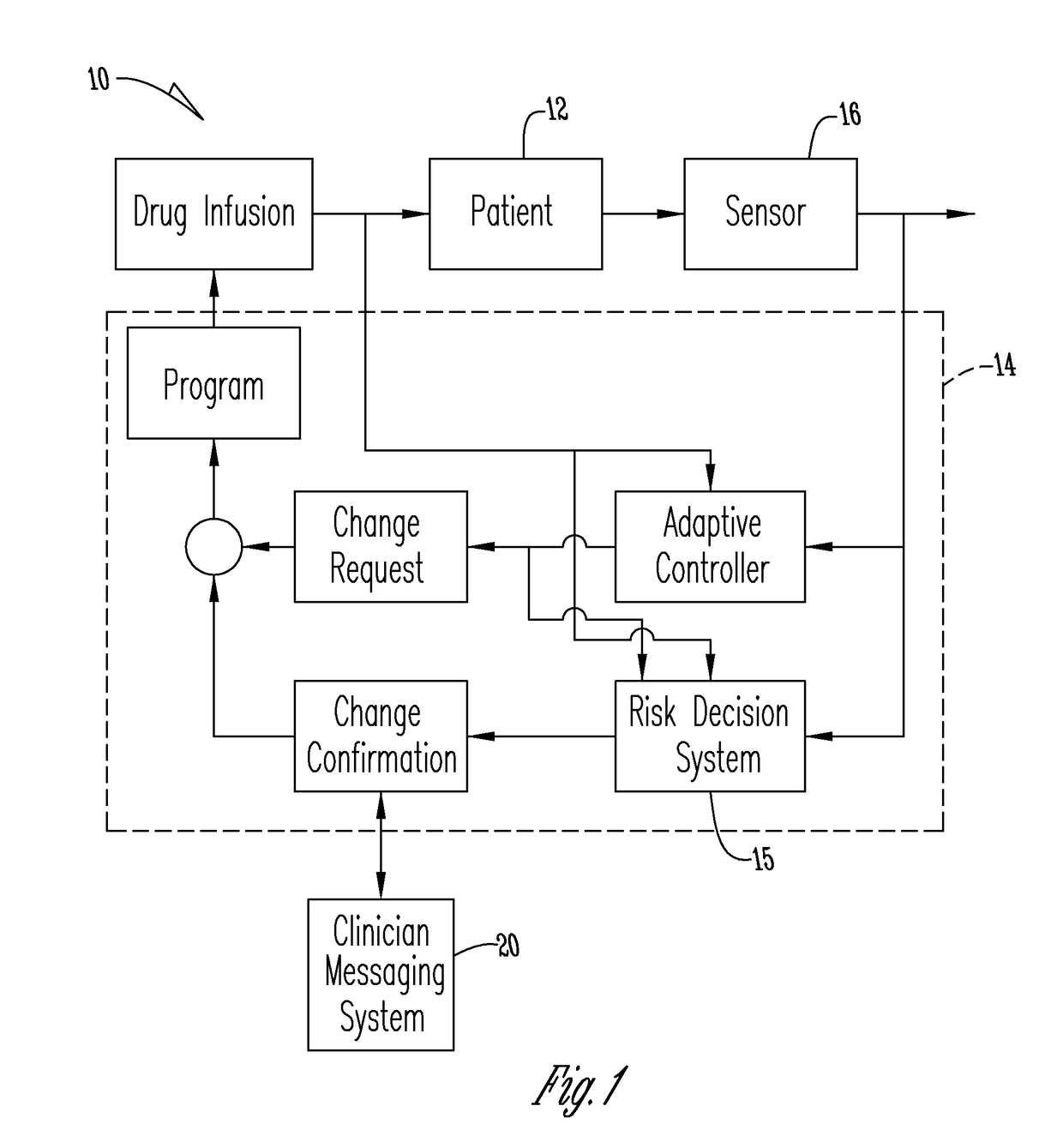

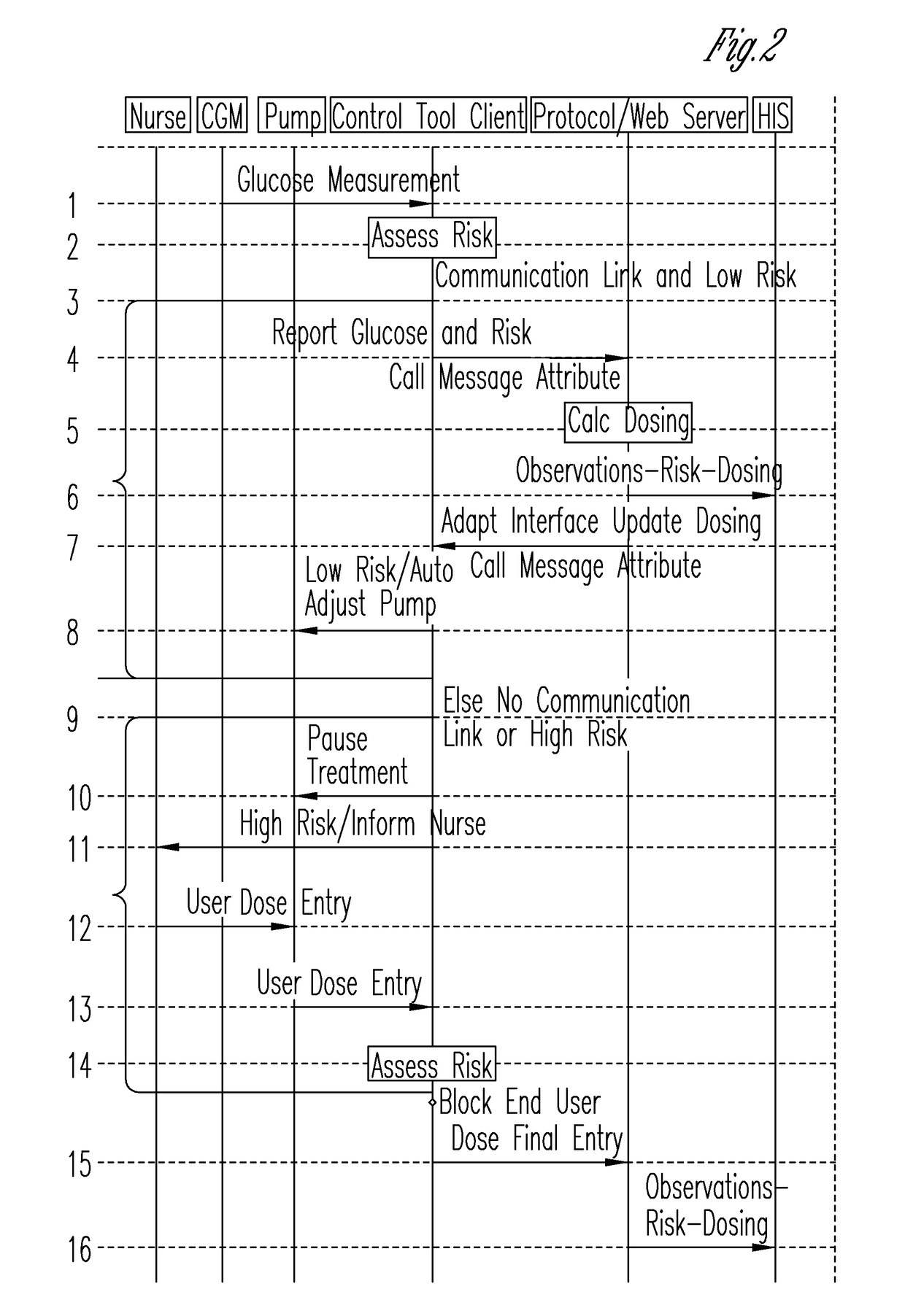

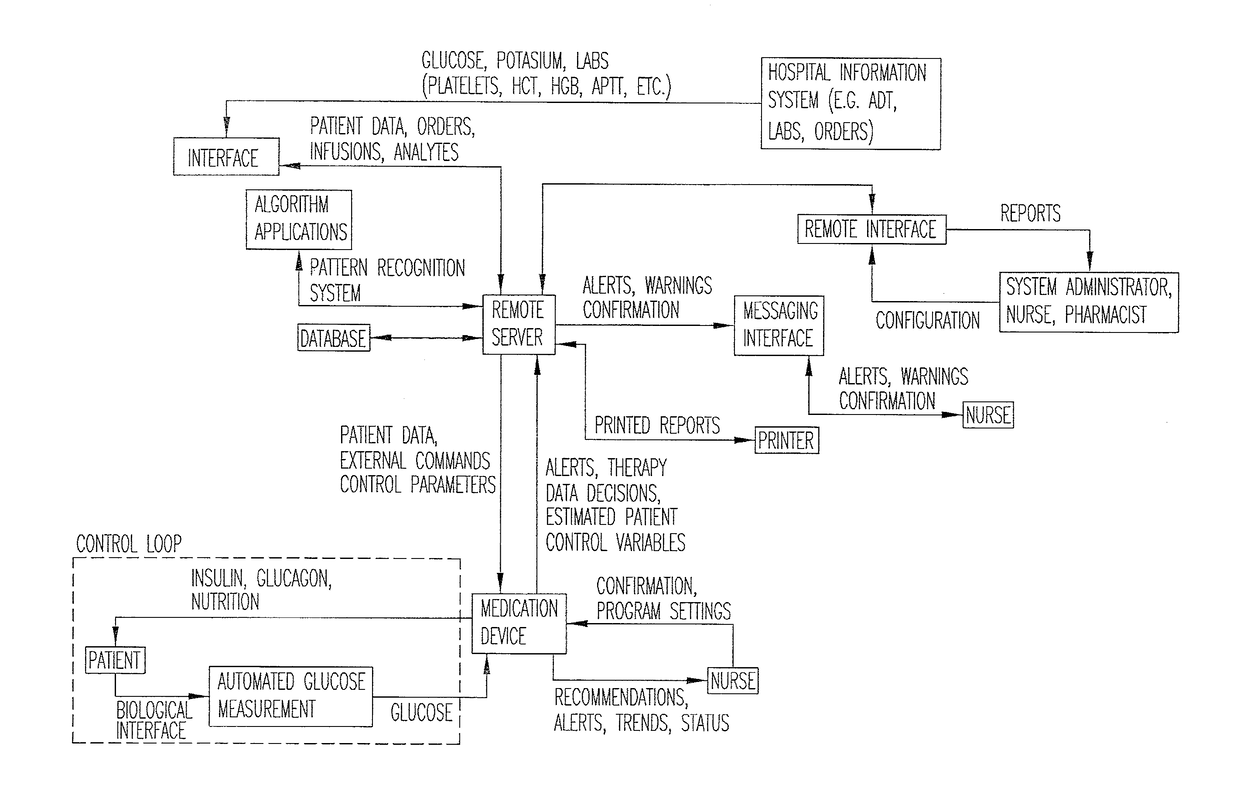

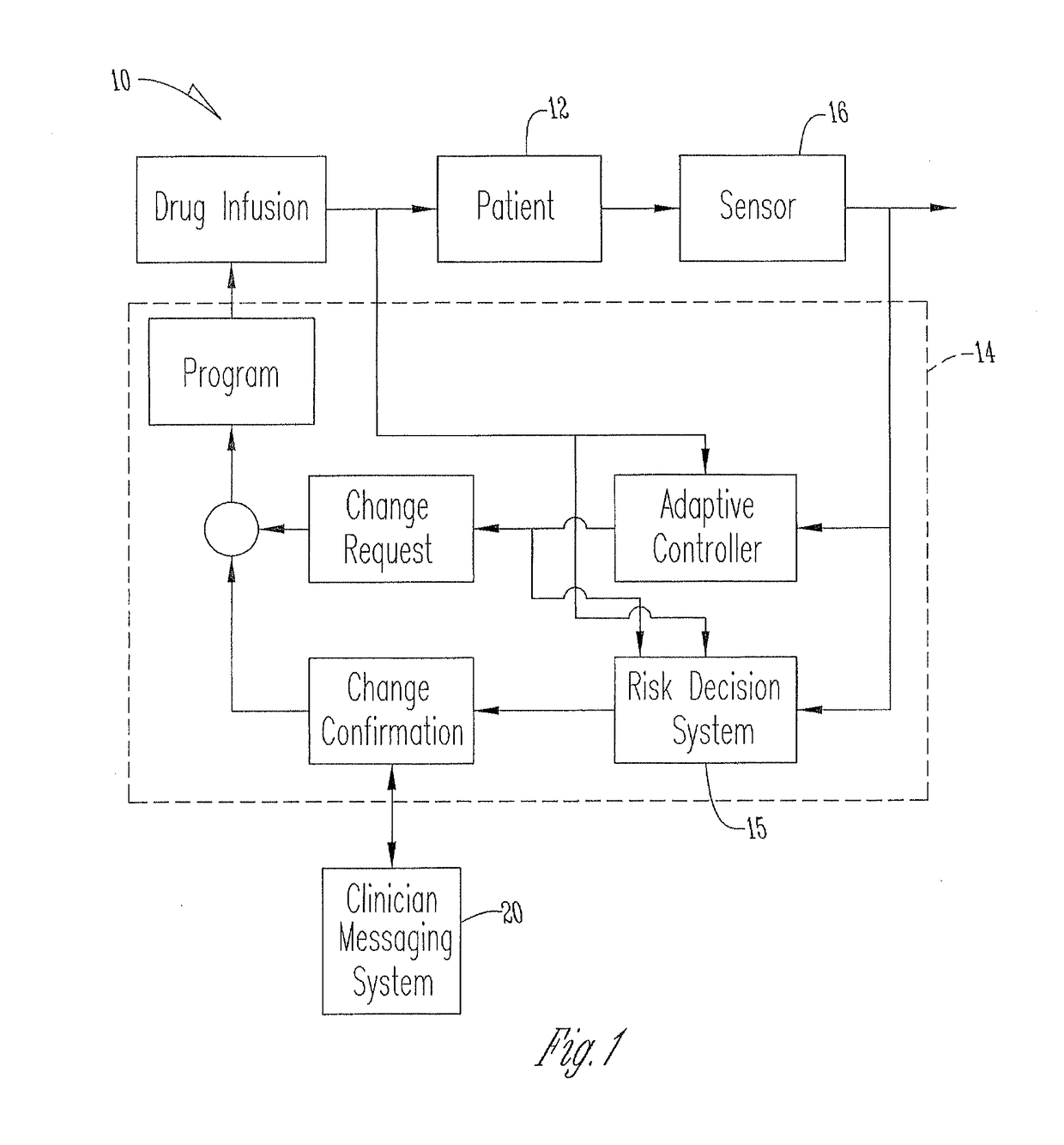

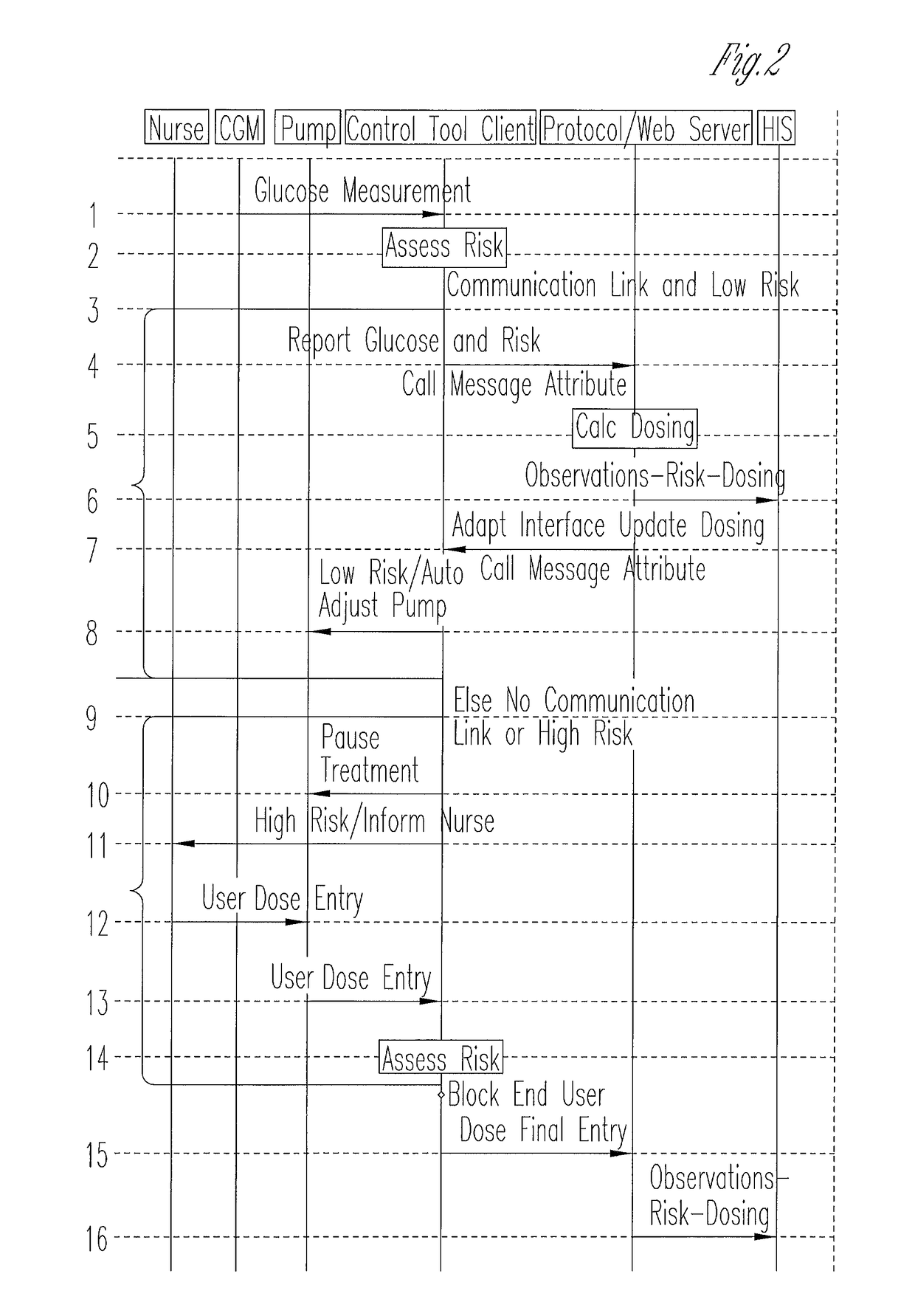

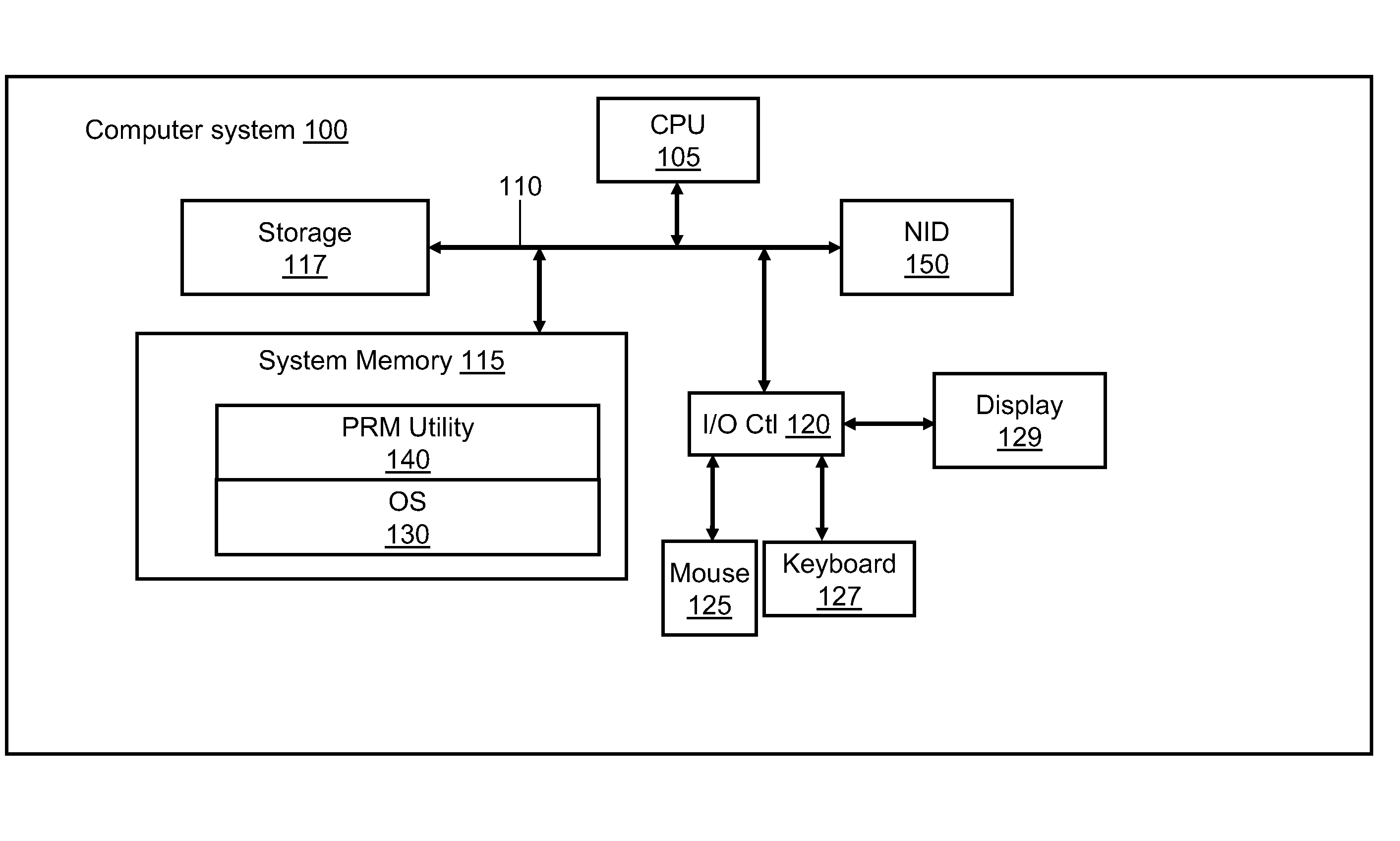

System for monitoring and delivering medication to a patient and method of using the same to minimize the risks associated with automated therapy

ActiveUS20130158504A1Potential riskRisk minimizationMedical simulationHealth-index calculationClosed loopMedical treatment

A system and method for monitoring and delivering medication to a patient includes a controller that has a control algorithm and a closed loop control that monitors the control algorithm. A sensor is in communication with the controller and monitors a medical condition. A rule base application in the controller receives data from the sensor and the closed loop control and compares the data to predetermined medical information to determine the risk of automation of therapy to the patient. The controller then provides a predetermined risk threshold where below the predetermined risk threshold automated closed loop medication therapy is provided. If the predetermined risk threshold is met or exceeded, automated therapy adjustments may not occur and user / clinician intervention is requested.

Owner:ICU MEDICAL INC

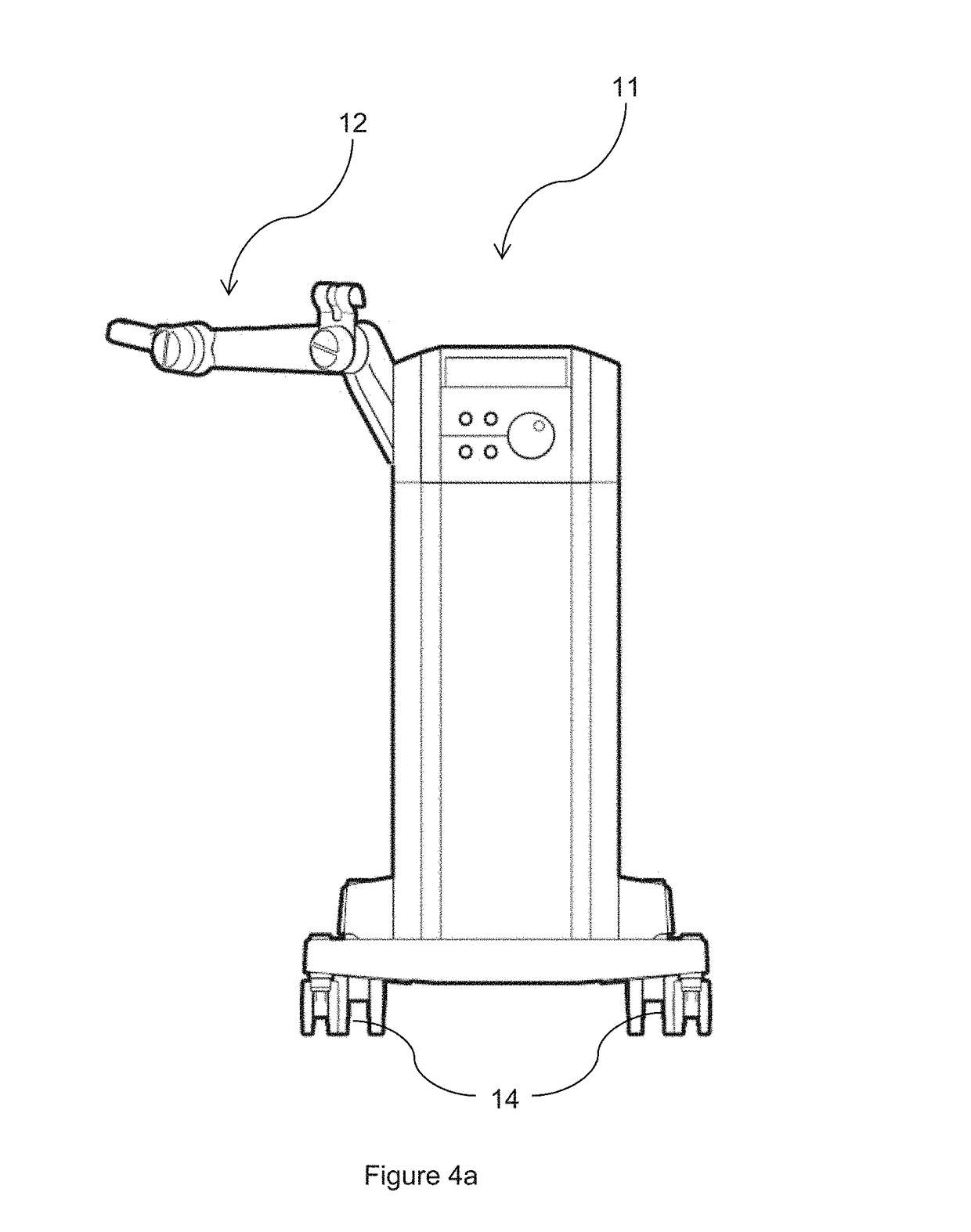

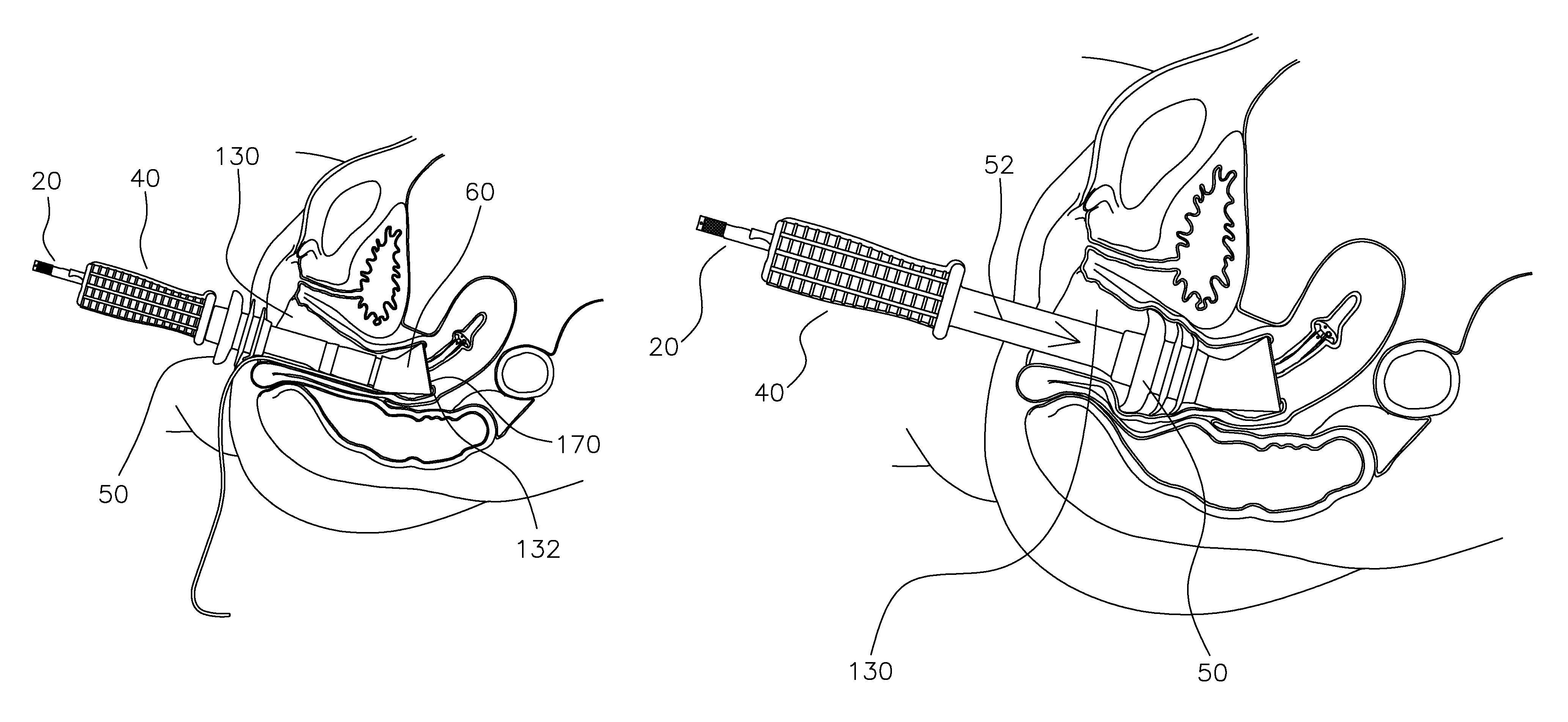

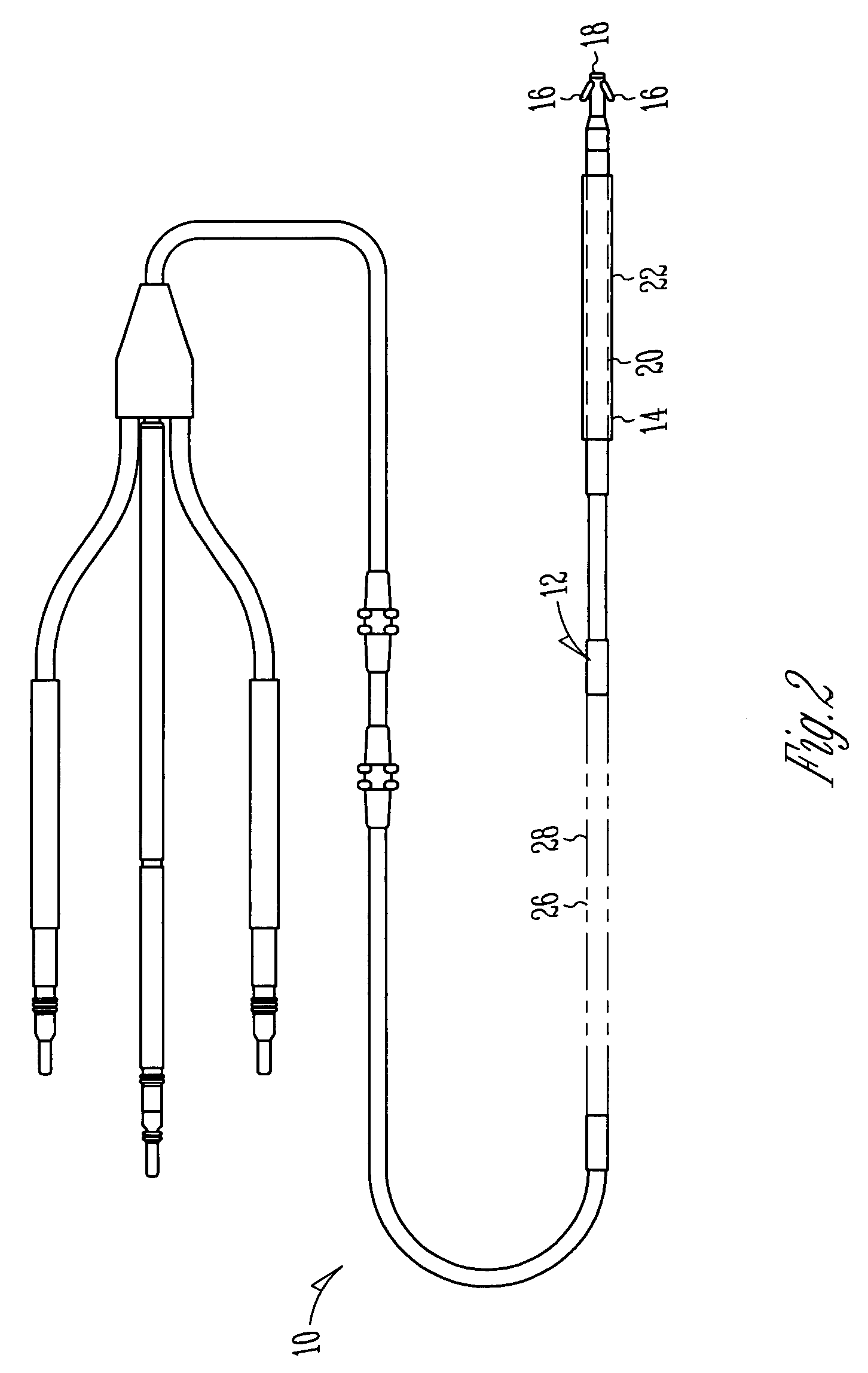

Ergonomic, lighted uterine manipulator with cautery

ActiveUS20120330324A1Easy to identifyFacilitates benefitDiagnosticsSurgical instrument detailsEngineeringUterine manipulator

A uterine manipulator includes a sound and a body. The sound has a selectively actuatable anchor disposed proximate a distal end and an operating mechanism spaced from the anchor for controlling actuation of the anchor. The body has a passage therethrough adapted to receive the sound passed proximally through the body to a position in which the operating mechanism is accessible proximally of the body and the anchor extends distally.

Owner:LSI SOLUTIONS

System for monitoring and delivering medication to a patient and method of using the same to minimize the risks associated with automated therapy

ActiveUS10022498B2Potential riskRisk minimizationMedical simulationHealth-index calculationClosed loopCvd risk

A system and method for monitoring and delivering medication to a patient includes a controller that has a control algorithm and a closed loop control that monitors the control algorithm. A sensor is in communication with the controller and monitors a medical condition. A rule base application in the controller receives data from the sensor and the closed loop control and compares the data to predetermined medical information to determine the risk of automation of therapy to the patient. The controller then provides a predetermined risk threshold where below the predetermined risk threshold automated closed loop medication therapy is provided. If the predetermined risk threshold is met or exceeded, automated therapy adjustments may not occur and user / clinician intervention is requested.

Owner:ICU MEDICAL INC

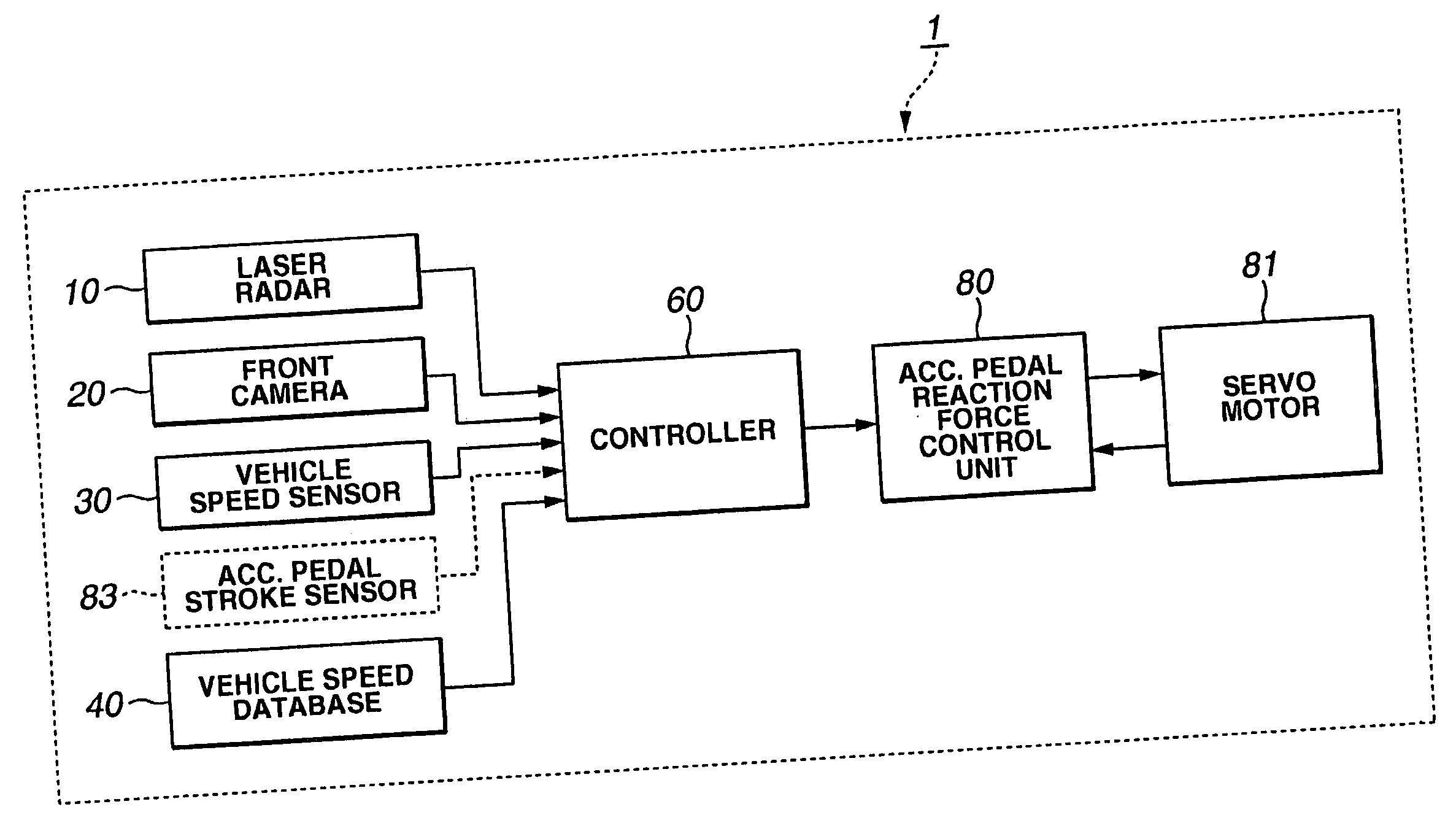

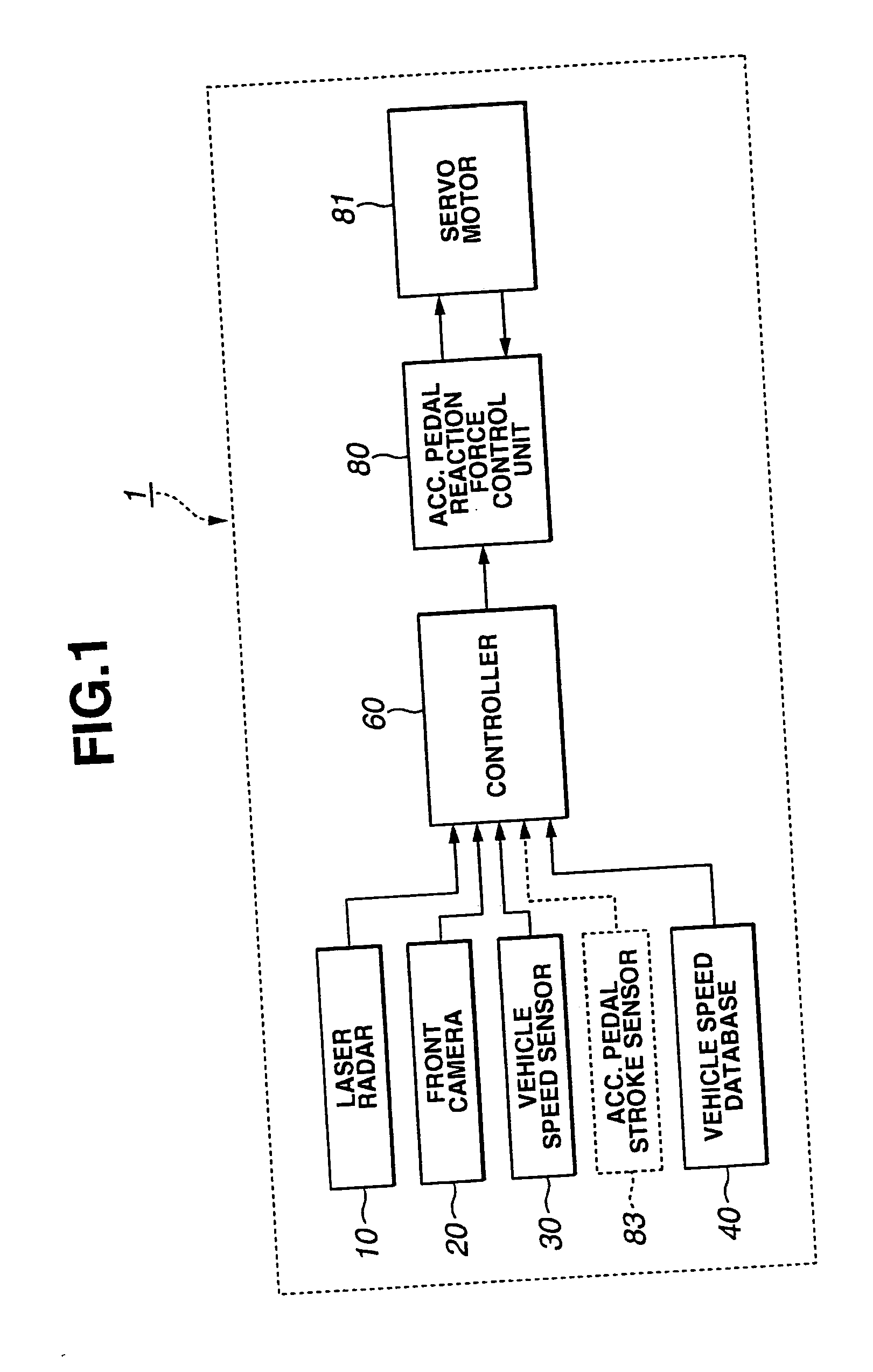

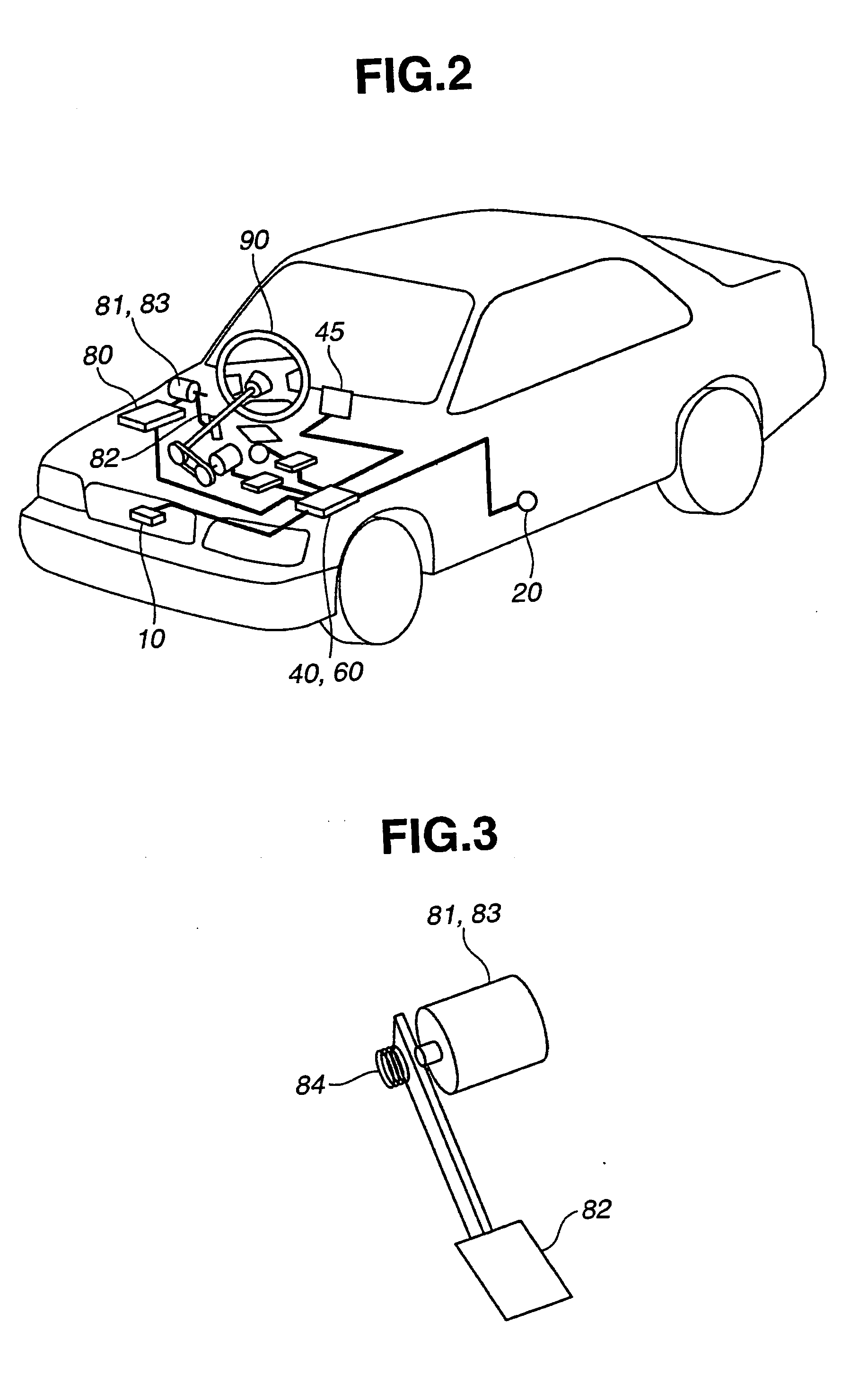

Driver assisting system, method for assisting driver, and vehicle incorporating same

A driver assisting system calculates a risk perceived (RP) by a driver from the environment, and a potential risk. At least one actuator is coupled to a driver controlled input device (or a driver's seat) to provide a first force to the driver controlled input device to stimulate the driver with a first form of tactile stimulus thereby to forward the calculated risk perceived (RP) to the driver, and to provide a second force to the driver controlled input device to stimulate driver with a second form of tactile stimulus thereby to forward the calculated potential risk to the driver.

Owner:NISSAN MOTOR CO LTD

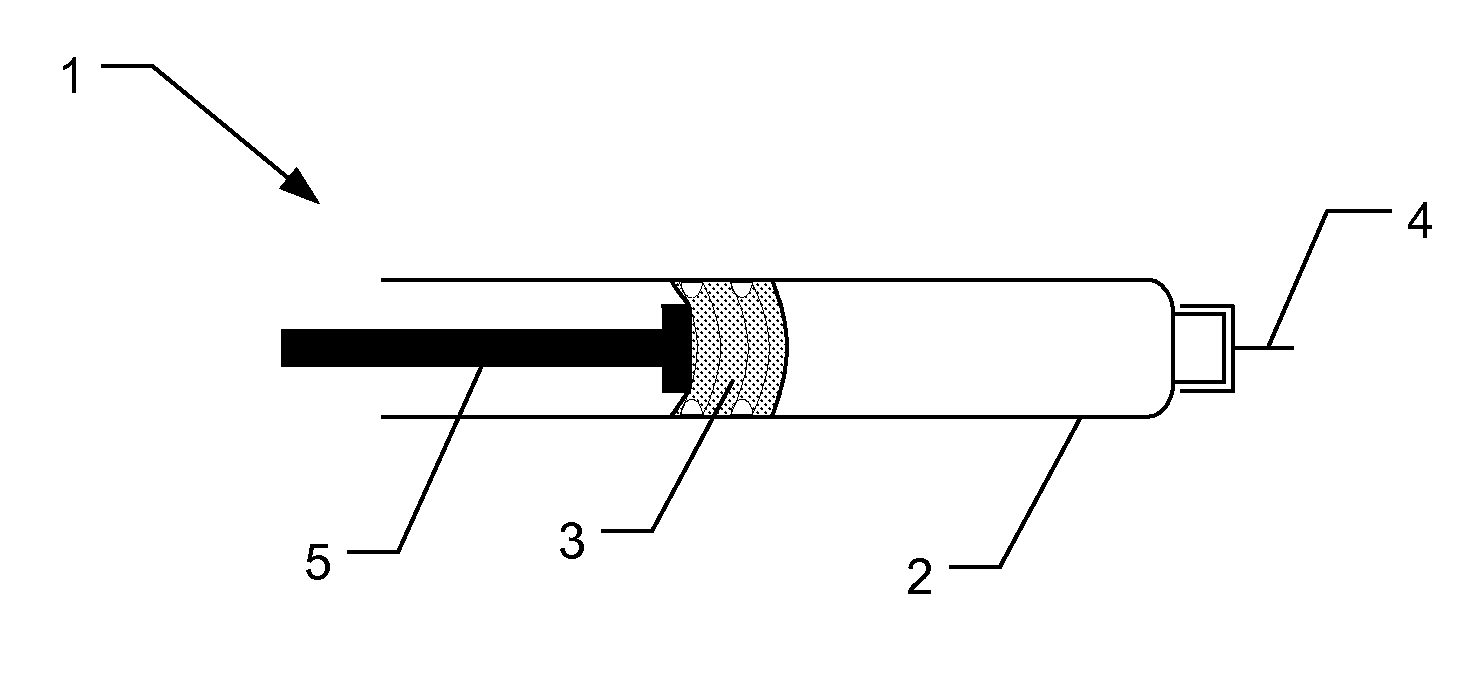

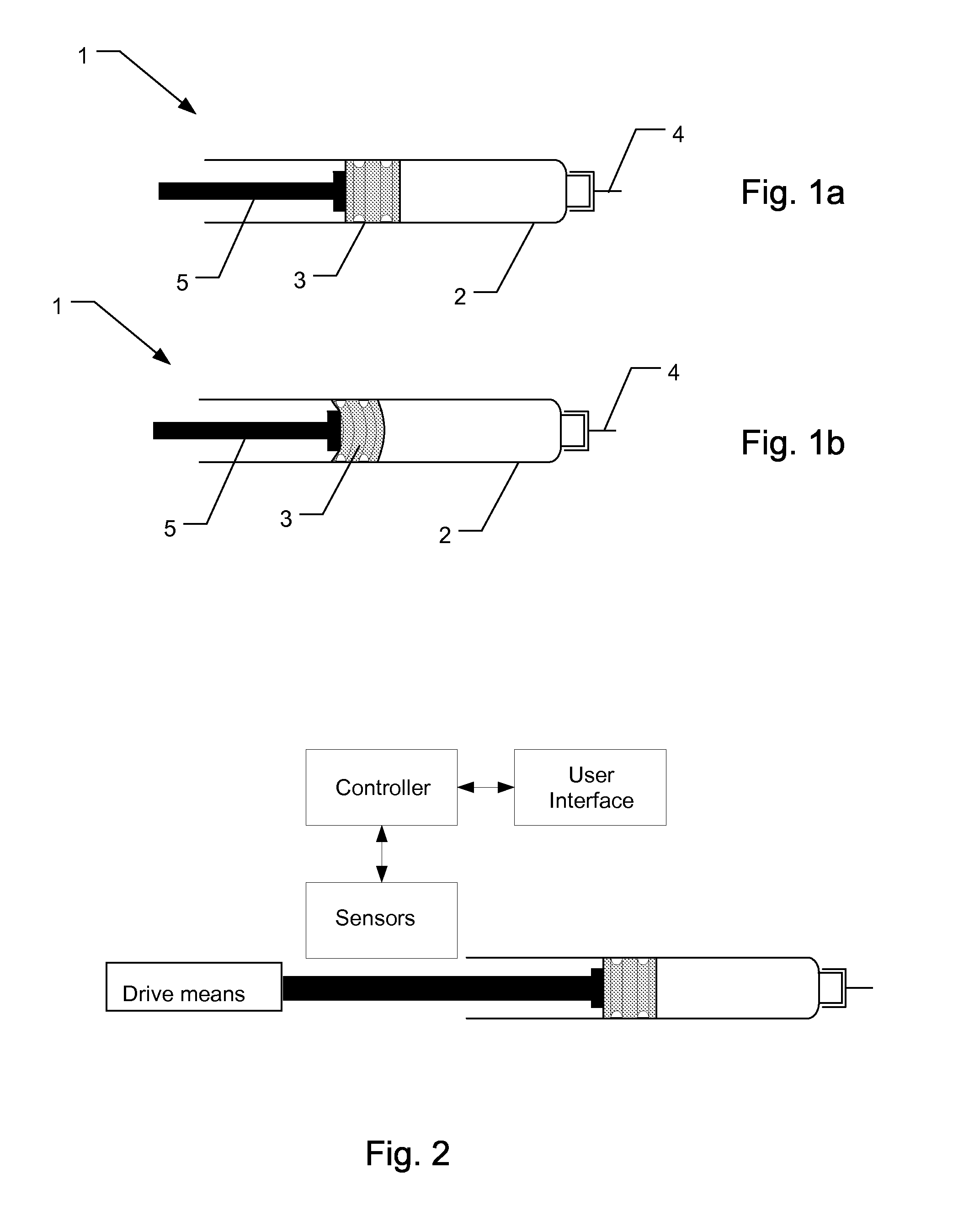

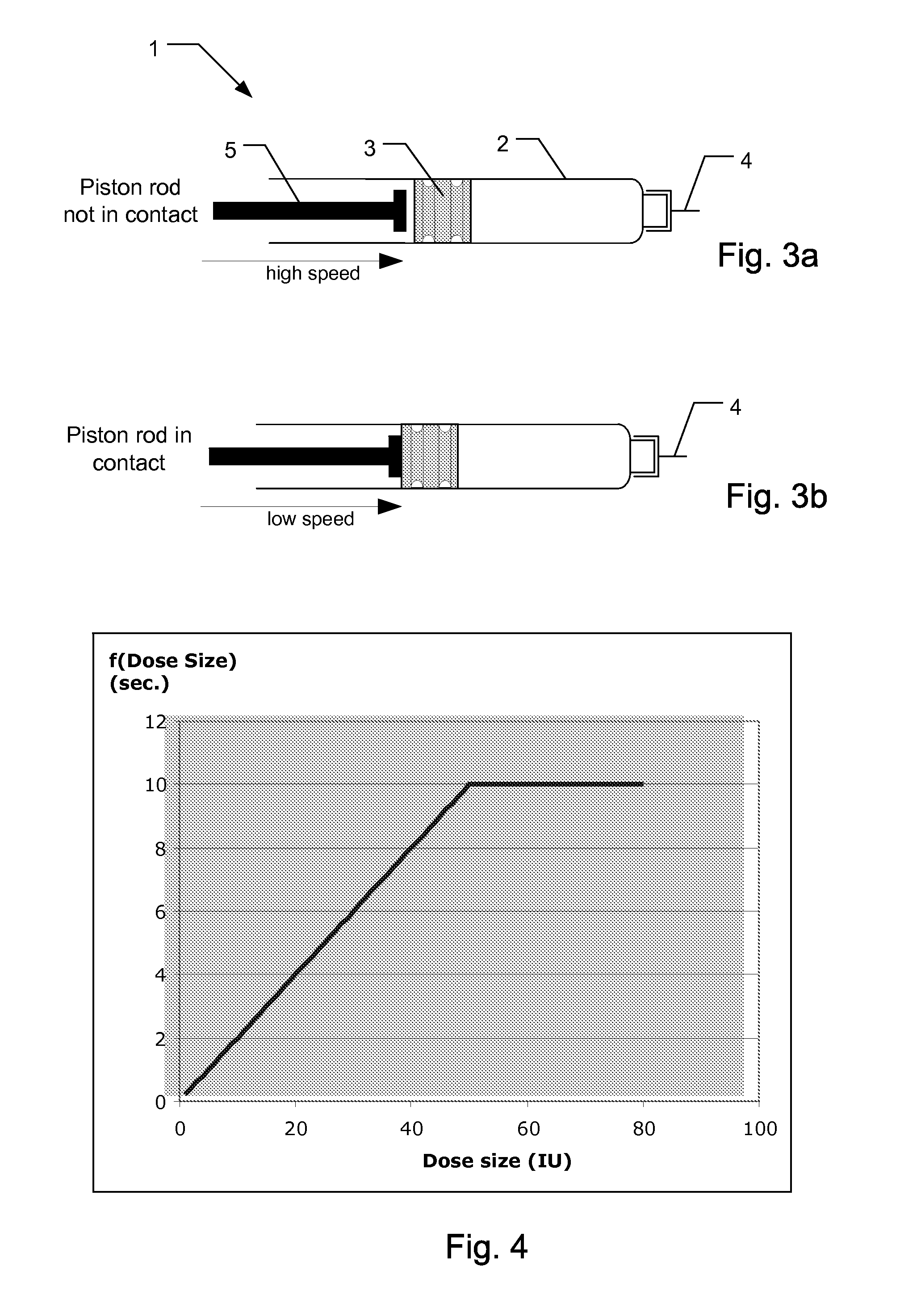

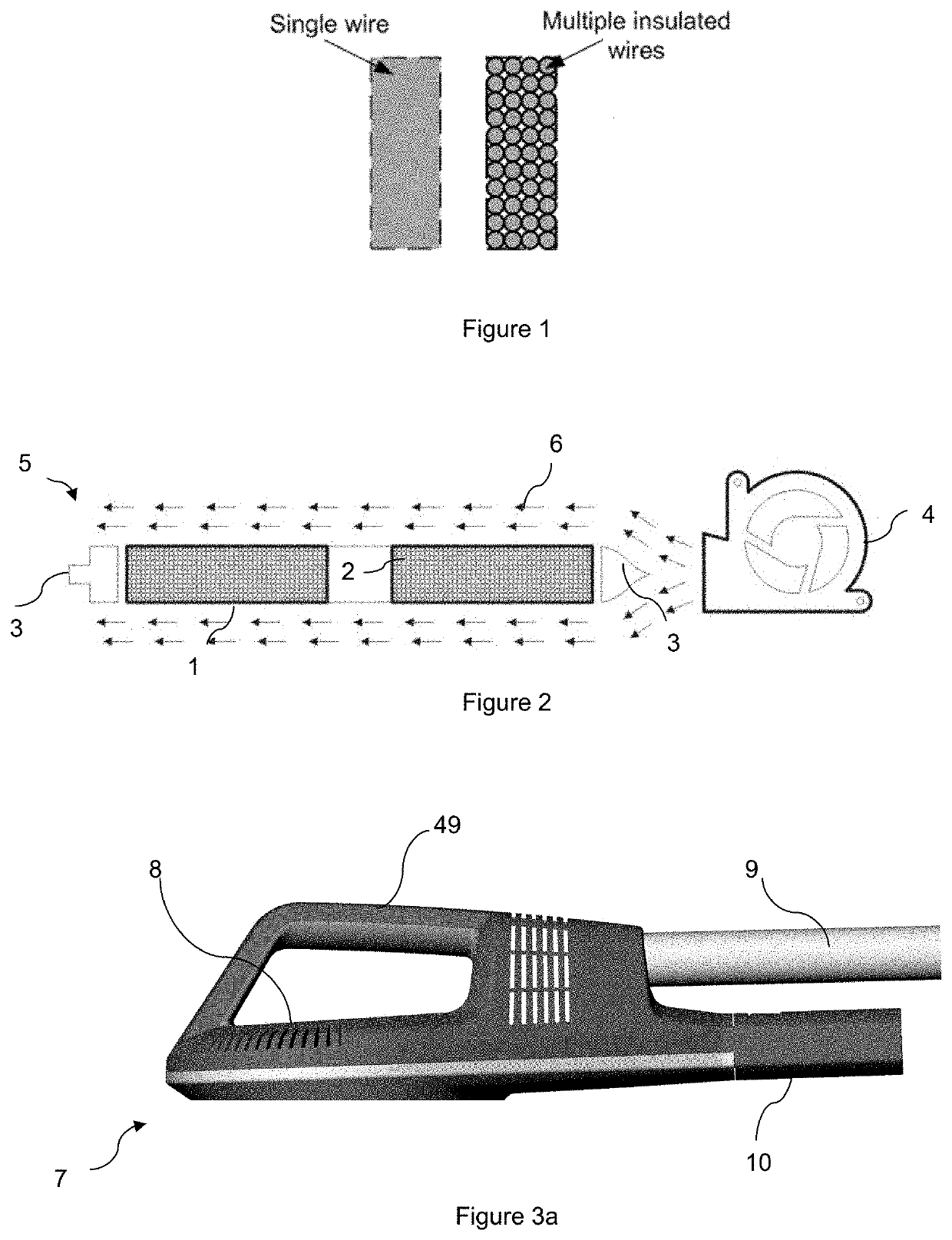

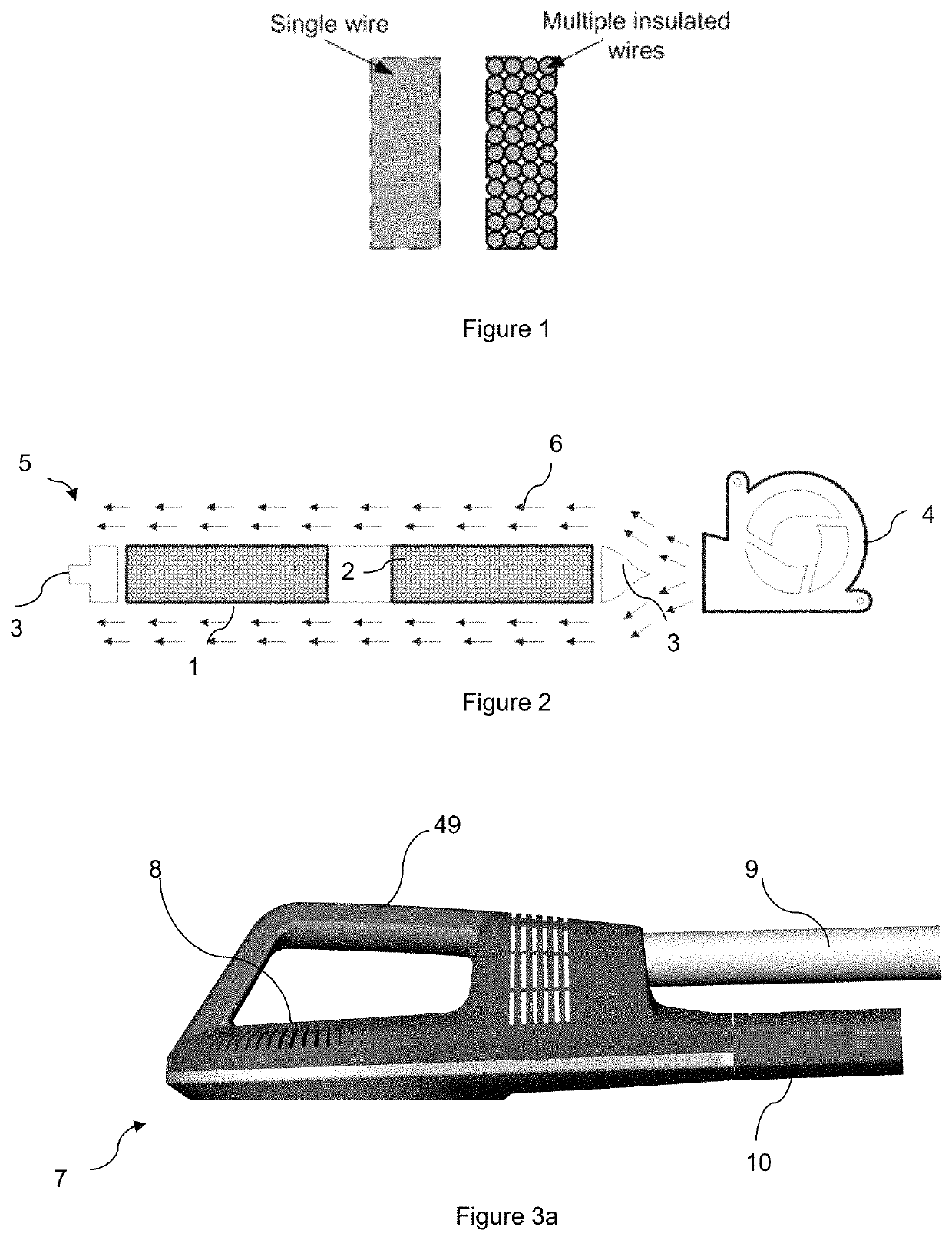

Electronically monitored injection device

ActiveUS20110009821A1Reduce riskHigh accuracy amountAutomatic syringesMedical devicesWaiting periodInjection device

The present invention relates to a medical injection device (1) for use in combination with a medicament filled cartridge (2), the injection device being provided with a spring-assisted injecting mechanism where energy released from the spring moves a plunger (3) of a held cartridge (2). Sensor circuitry is adapted to detect speed related data during injection so at to detect an abnormal speed condition, such as a needle blocking condition, a priming condition or an air purge condition. The invention also relates to a medical injection device comprising sensor circuitry and user communicating means to provide a recommended needle retraction waiting period which is dependent on the speed of injection.

Owner:NOVO NORDISK AS

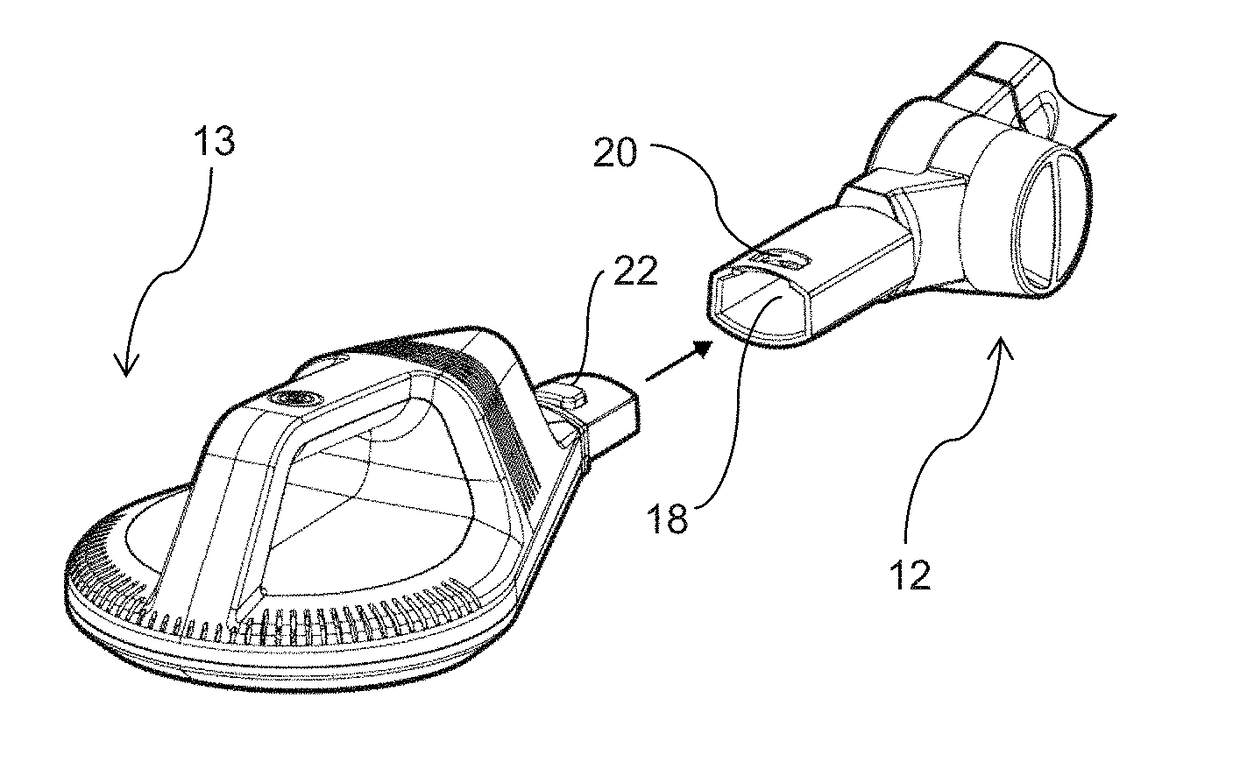

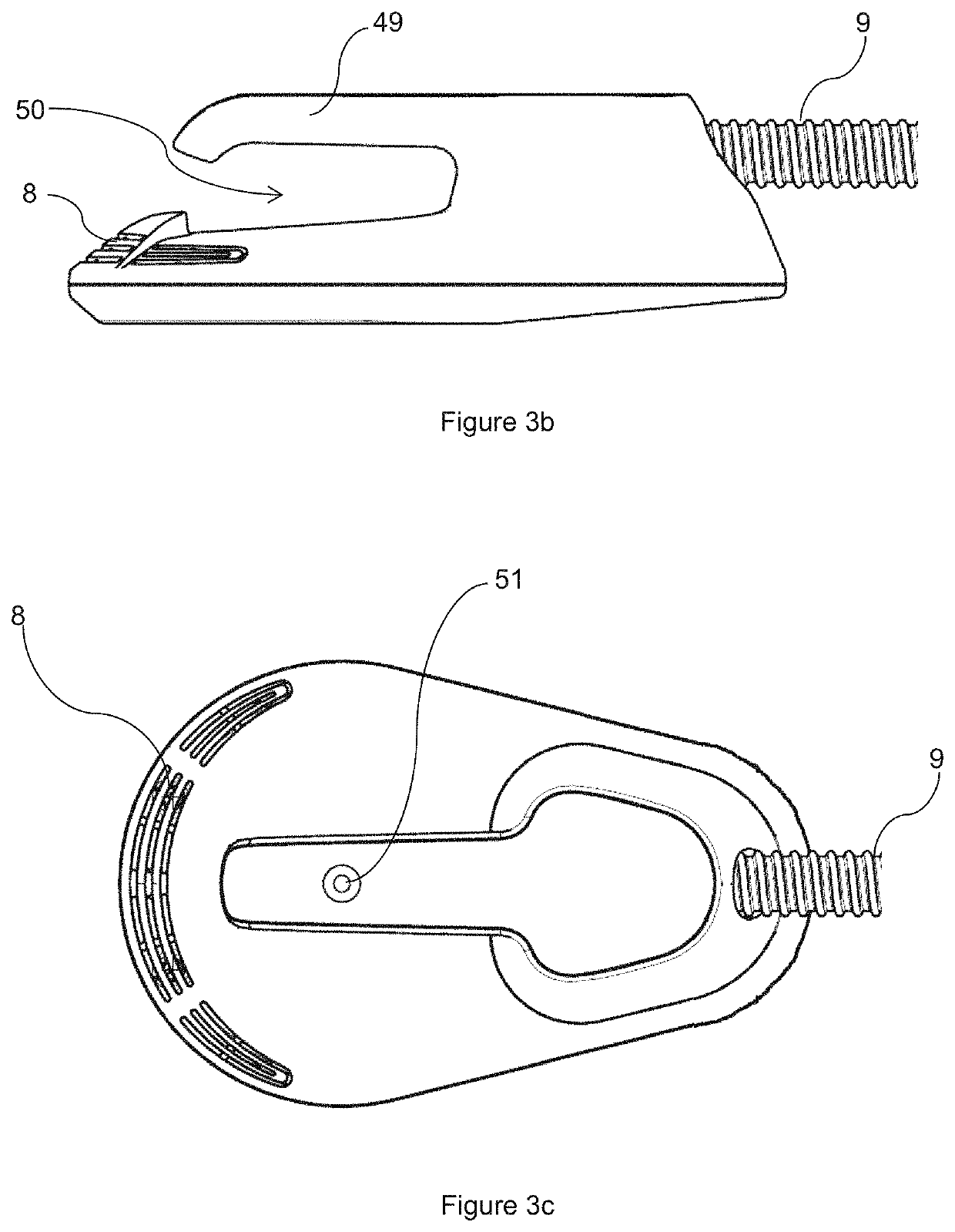

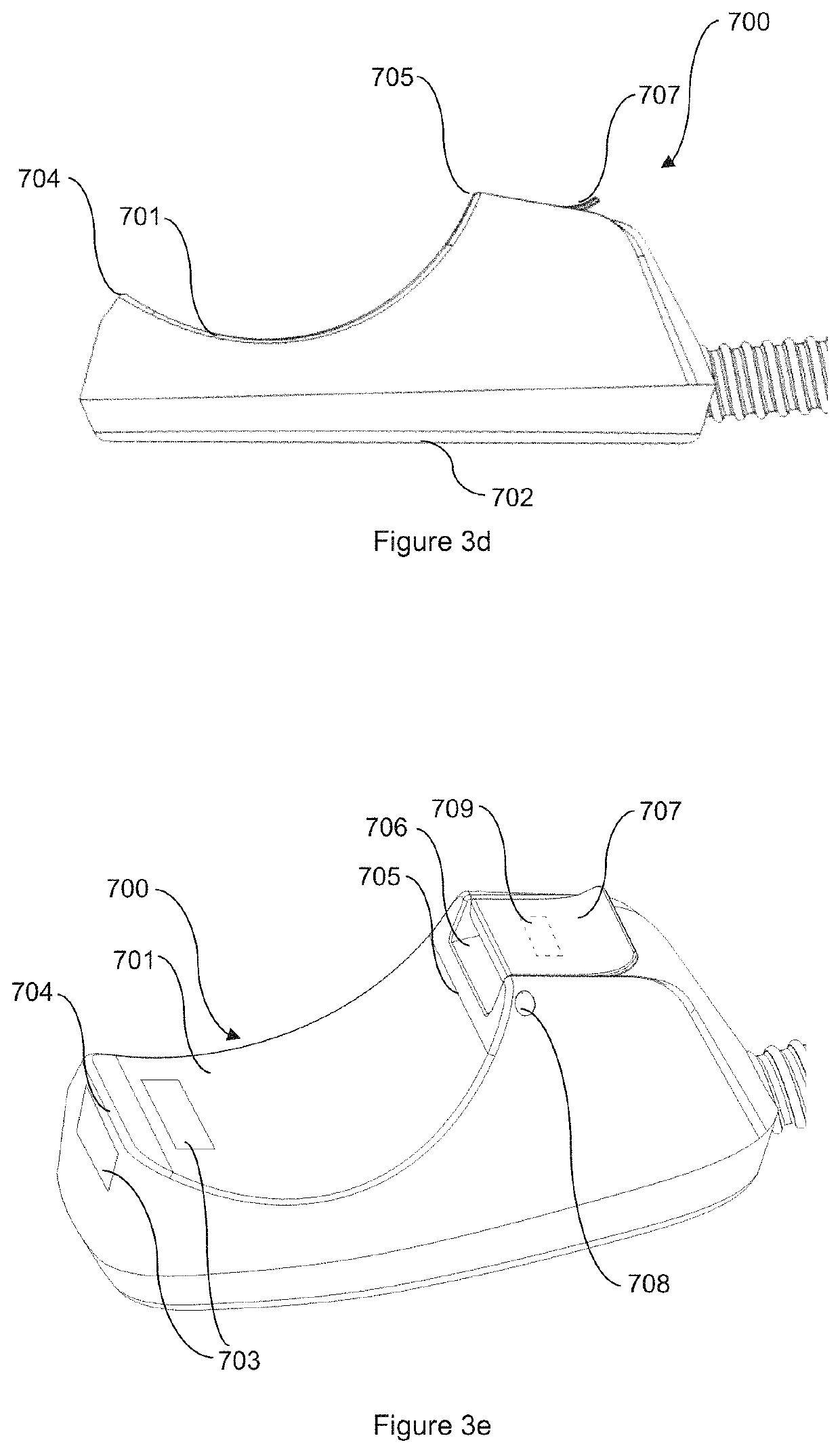

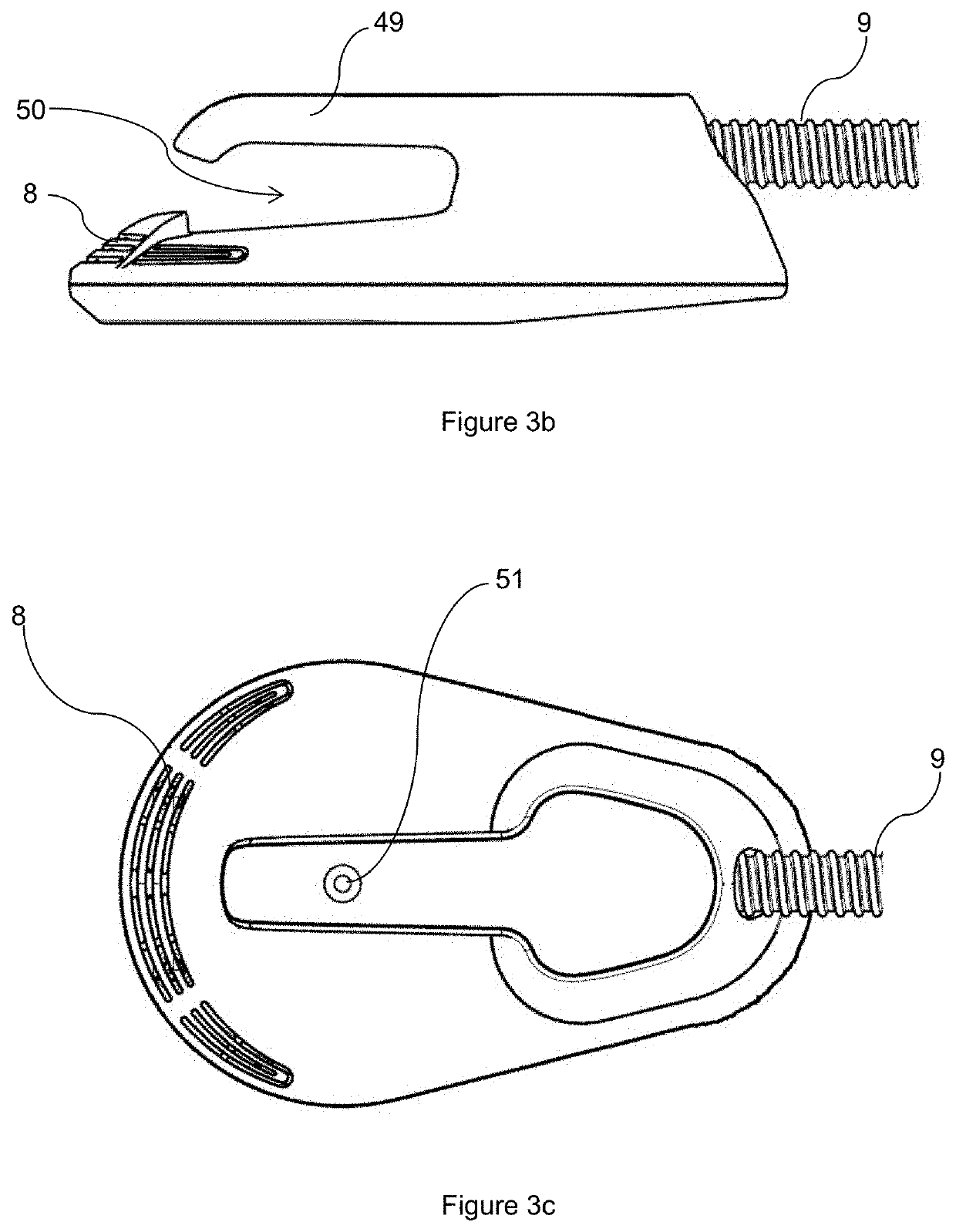

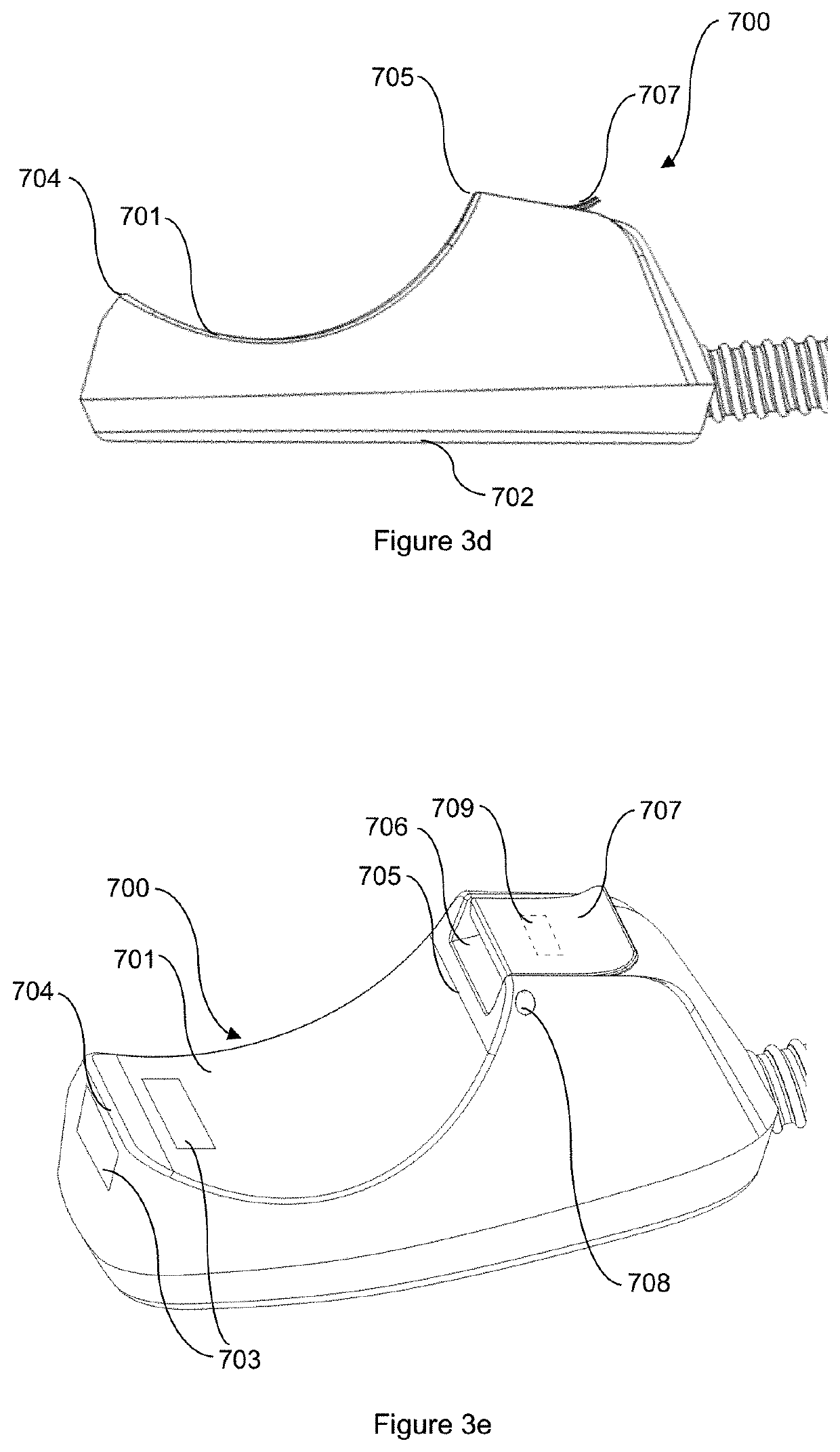

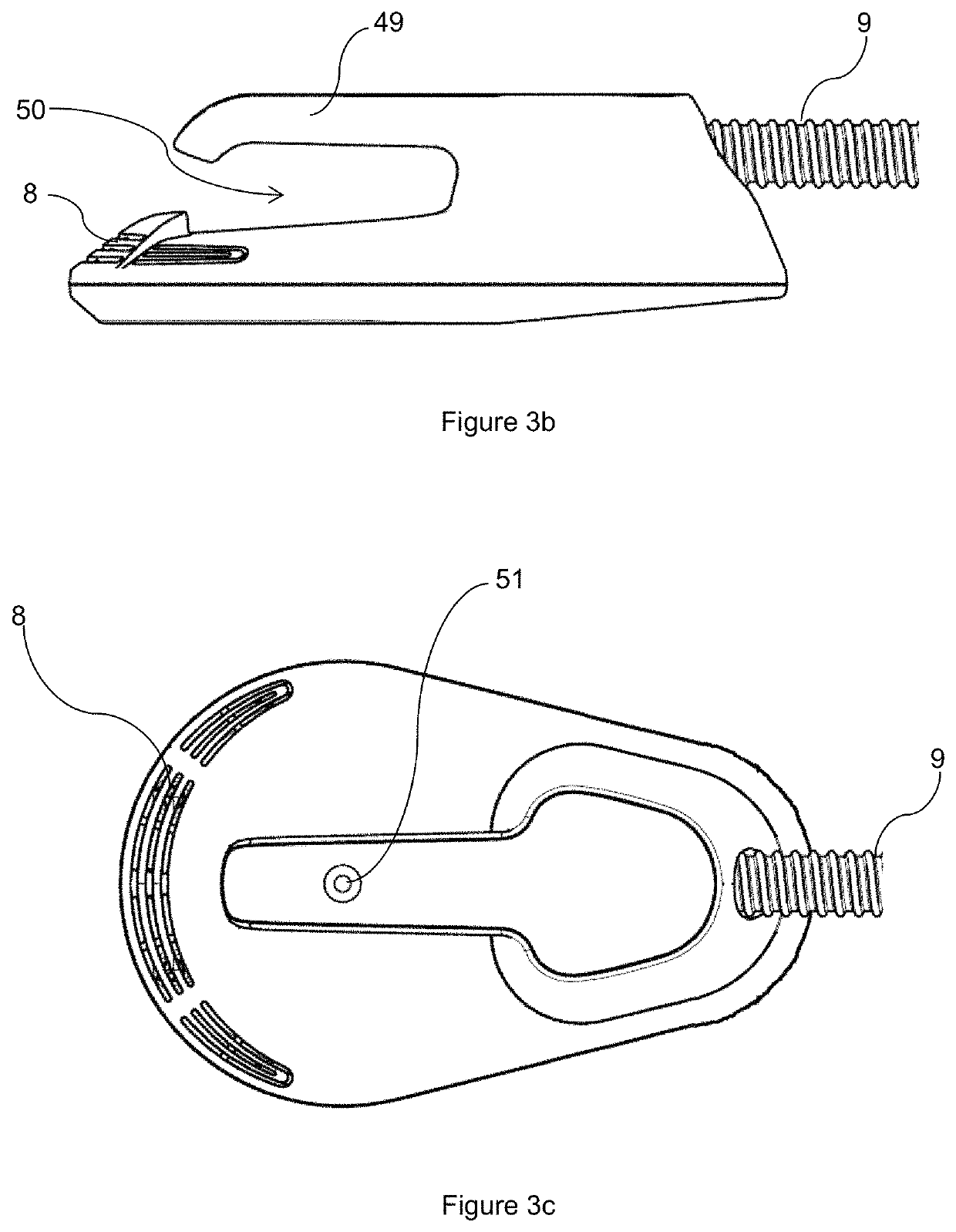

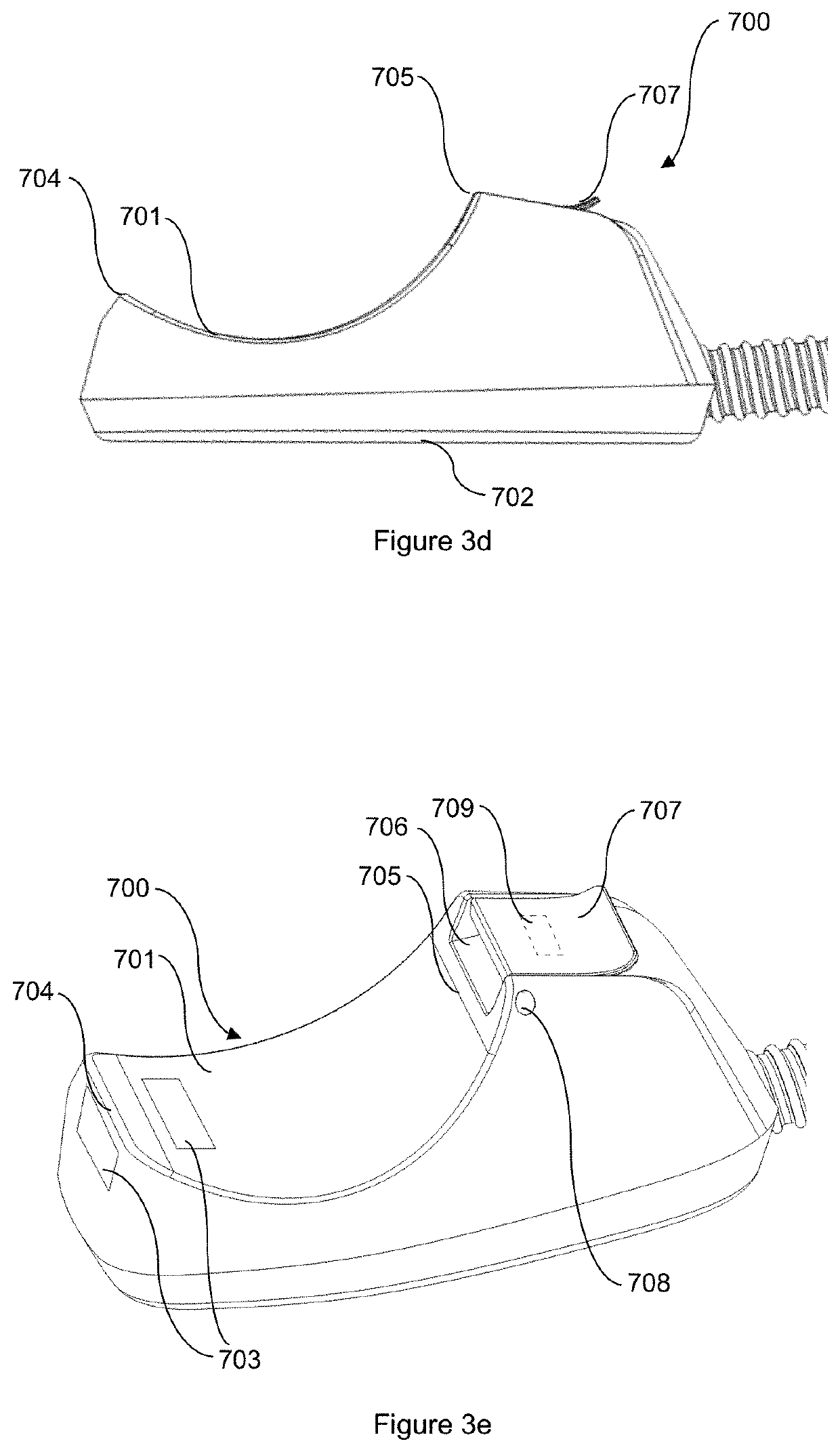

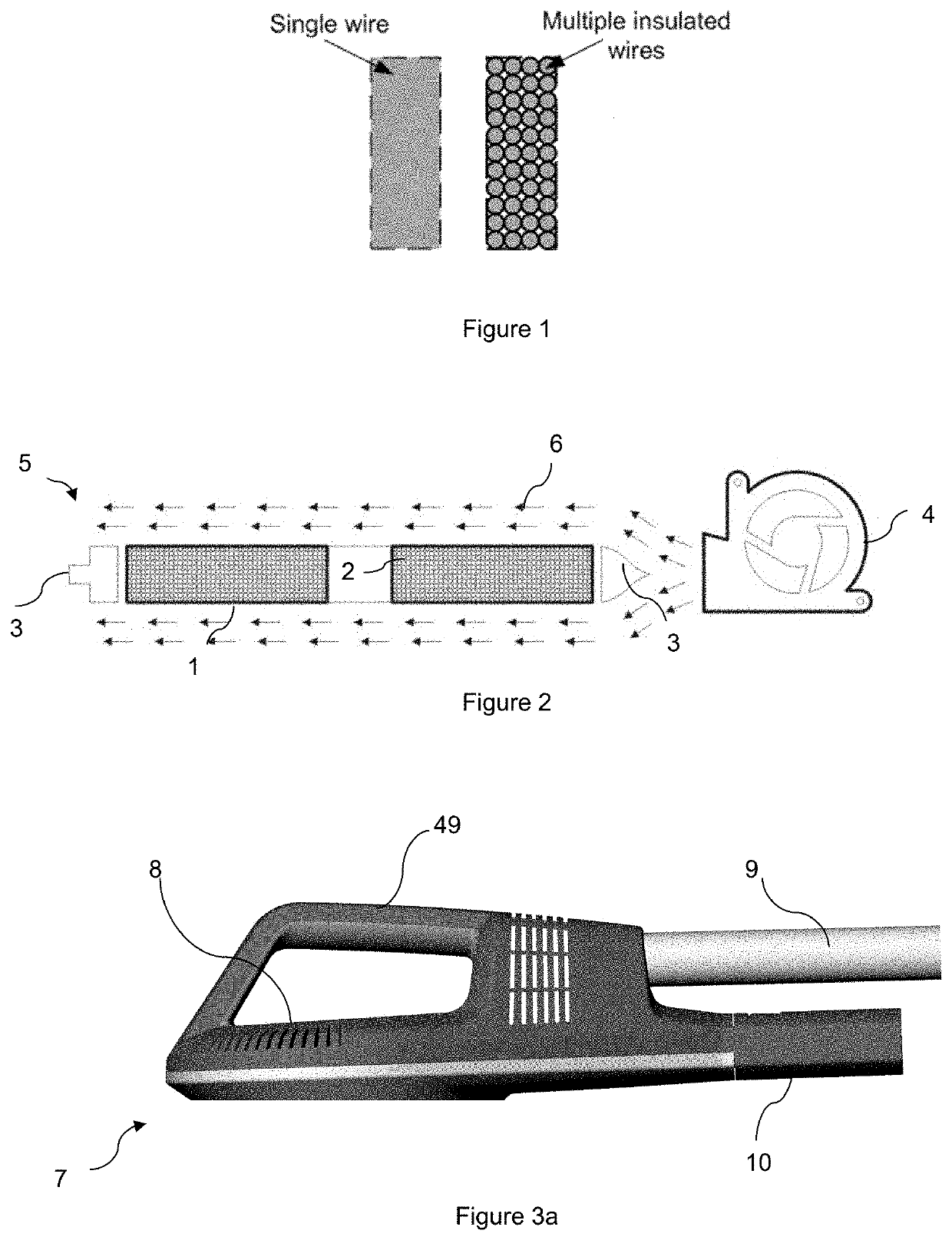

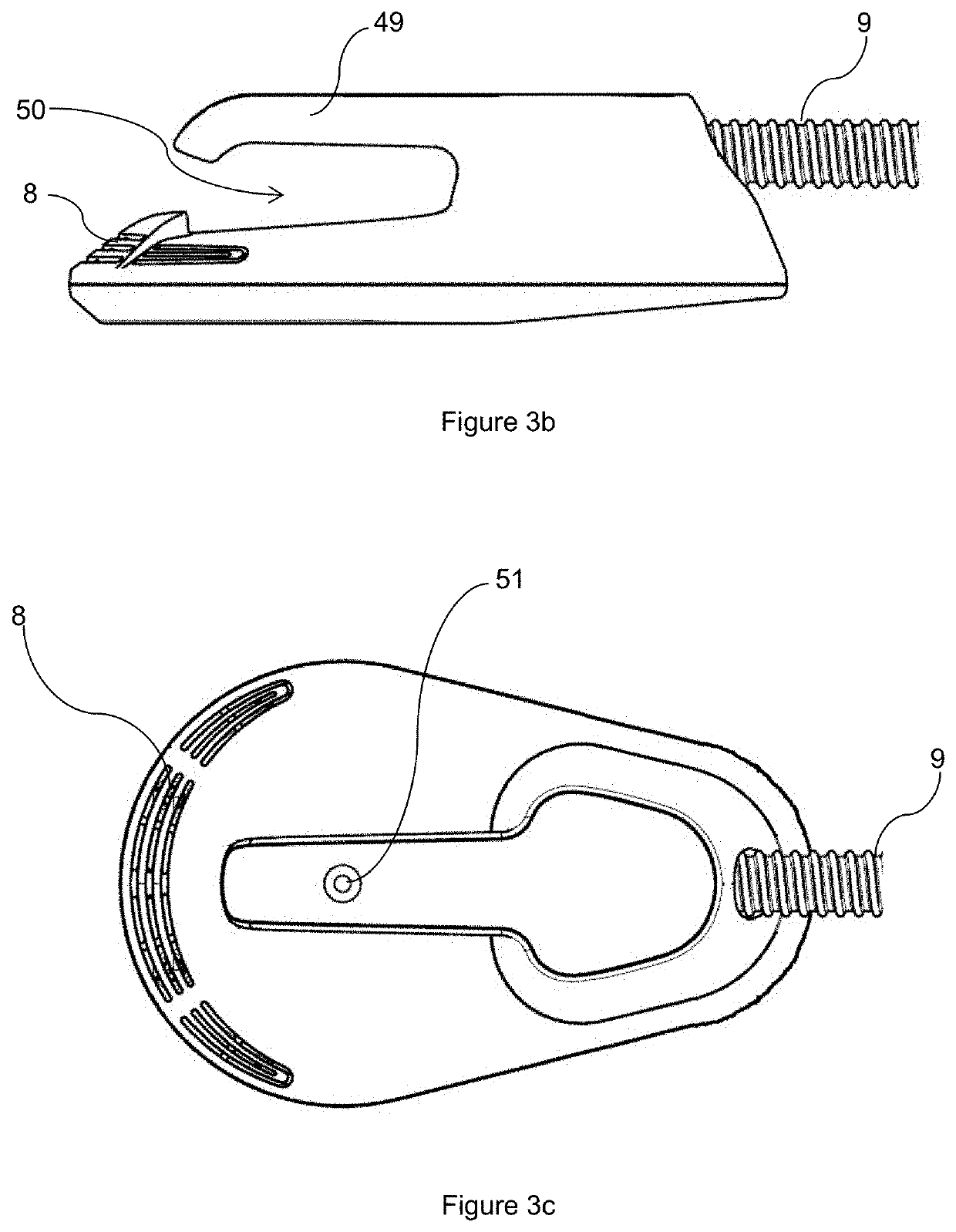

Aesthetic method of biologoical structure treatment by magnetic field

ActiveUS9974519B1Improve the effectiveness of treatmentReduce self-heatingAnti-cellulite devicesOrgan movement/changes detectionMedicineVisual perception

Methods for treating a patient using time varying magnetic field are described. The treatment methods combine various approaches for aesthetic treatment. The methods are focused on enhancing a visual appearance of the patient. In one embodiment, the method is performed by switching on a device which includes a connection to an energy source, an energy storage device, a switching device and a magnetic field generating device including a core, and applying a time-varying field with a maximal value of magnetic flux density derivative of at least 300 T / s to a muscle of the patient. The diameter of the core is up to 80% of an outer diameter of the magnetic field generating device.

Owner:BTL MEDICAL SOLUTIONS AS

System for monitoring and delivering medication to a patient and method of using the same to minimize the risks associated with automated therapy

ActiveUS9724470B2Potential riskRisk minimizationDrug and medicationsMedical devicesRemote systemClosed loop

A system and method for monitoring and delivering medication to a patient. The system includes a controller that has a control algorithm and a closed loop control that monitors the control algorithm. A sensor is in communication with the controller and monitors a medical condition. A rule based application in the controller receives data from the sensor and the closed loop control and compares the data to predetermined medical information to determine the risk of automation of therapy to the patient. A system monitor is also in communication with the controller to monitor system, remote system, and network activity and conditions. The controller then provides a predetermined risk threshold where below the predetermined risk threshold automated closed loop medication therapy is provided. If the predetermined risk threshold is met or exceeded, automated therapy adjustments may not occur and user / clinician intervention is requested.

Owner:ICU MEDICAL INC

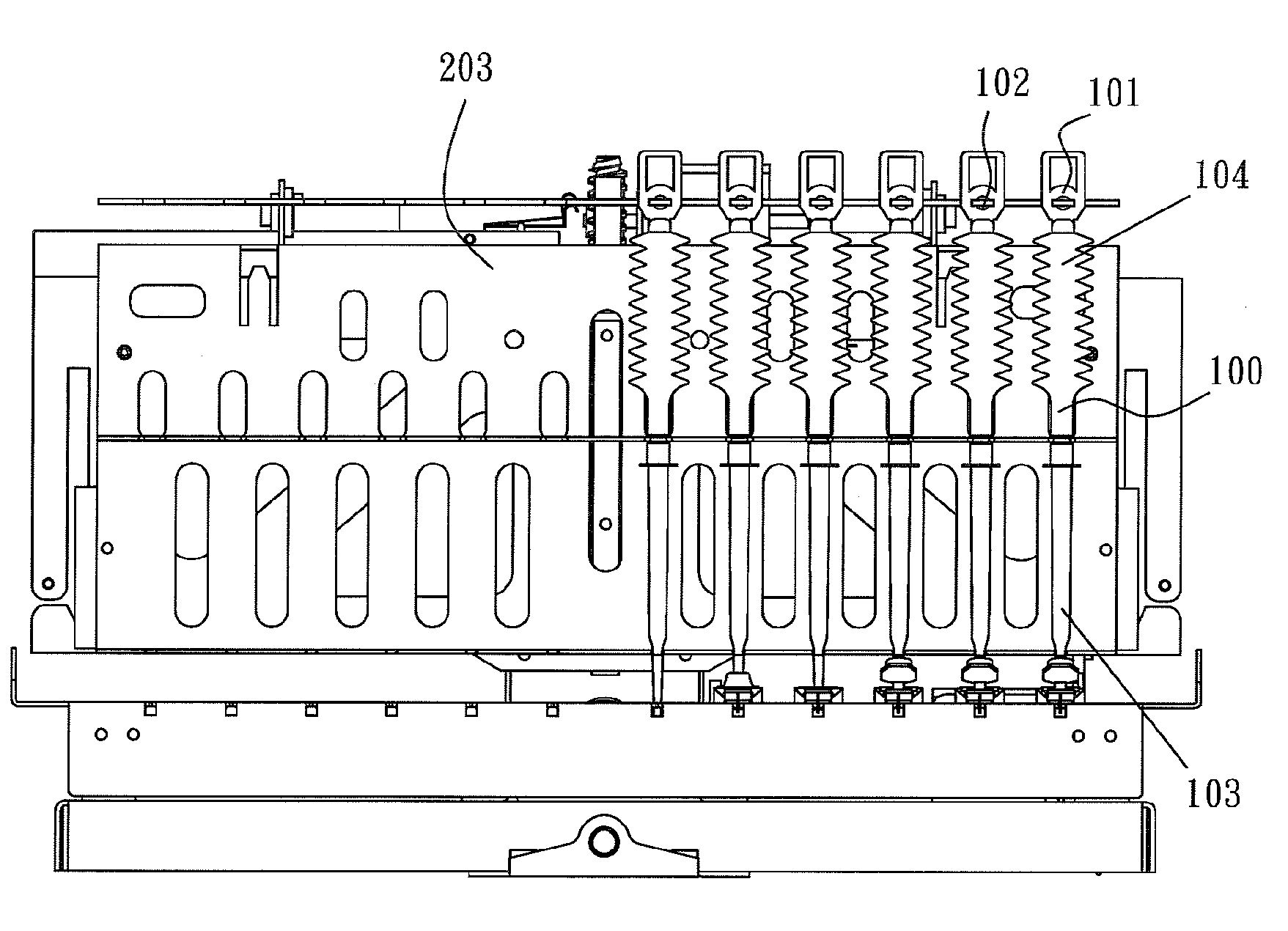

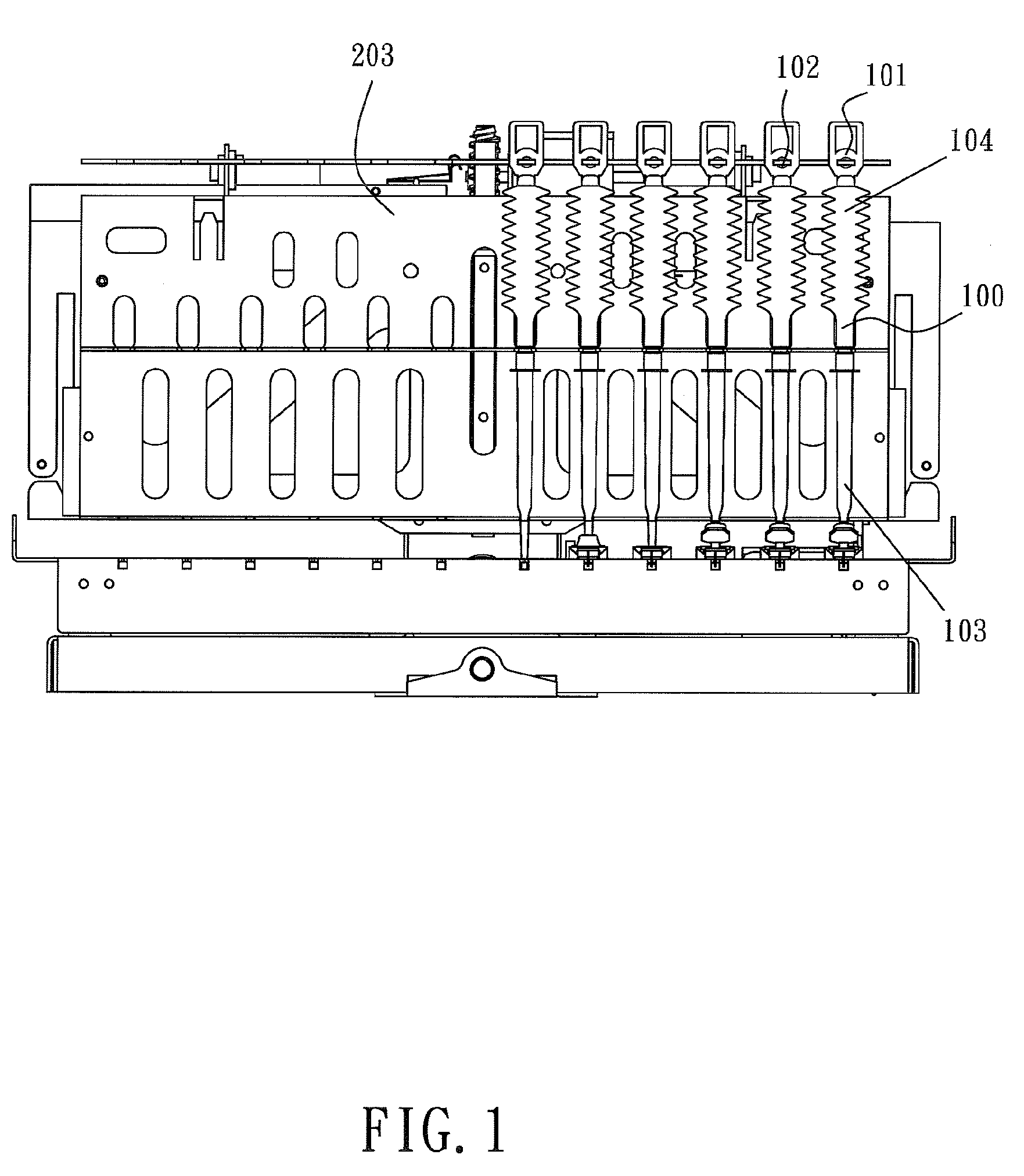

Liquid transfer device

InactiveUS20090074624A1Potential riskEasy to controlAnalysis using chemical indicatorsAnalysis by subjecting material to chemical reactionInterior spaceTest agent

A liquid transfer device is provided for biochemical assay, including a pipette forming an interior space extending in an axial direction and having first and second ends. The first end forms an opening and the second end forms an enclosed variable volume, whereby variation of the volume causes a change of pressure to selectively induce a suction force and a releasing force in the pipette. An analysis container includes a plurality of receptacles retained by a slab. A film covers the slab to seal the container. A movement control device includes a manipulator that releasably holds the pipette and a tray that forms a cavity for receiving and retaining the container. The pipette and the tray are movable with respect to each other in order to fill / draw test agent into / out of the receptacles.

Owner:LIANG DON

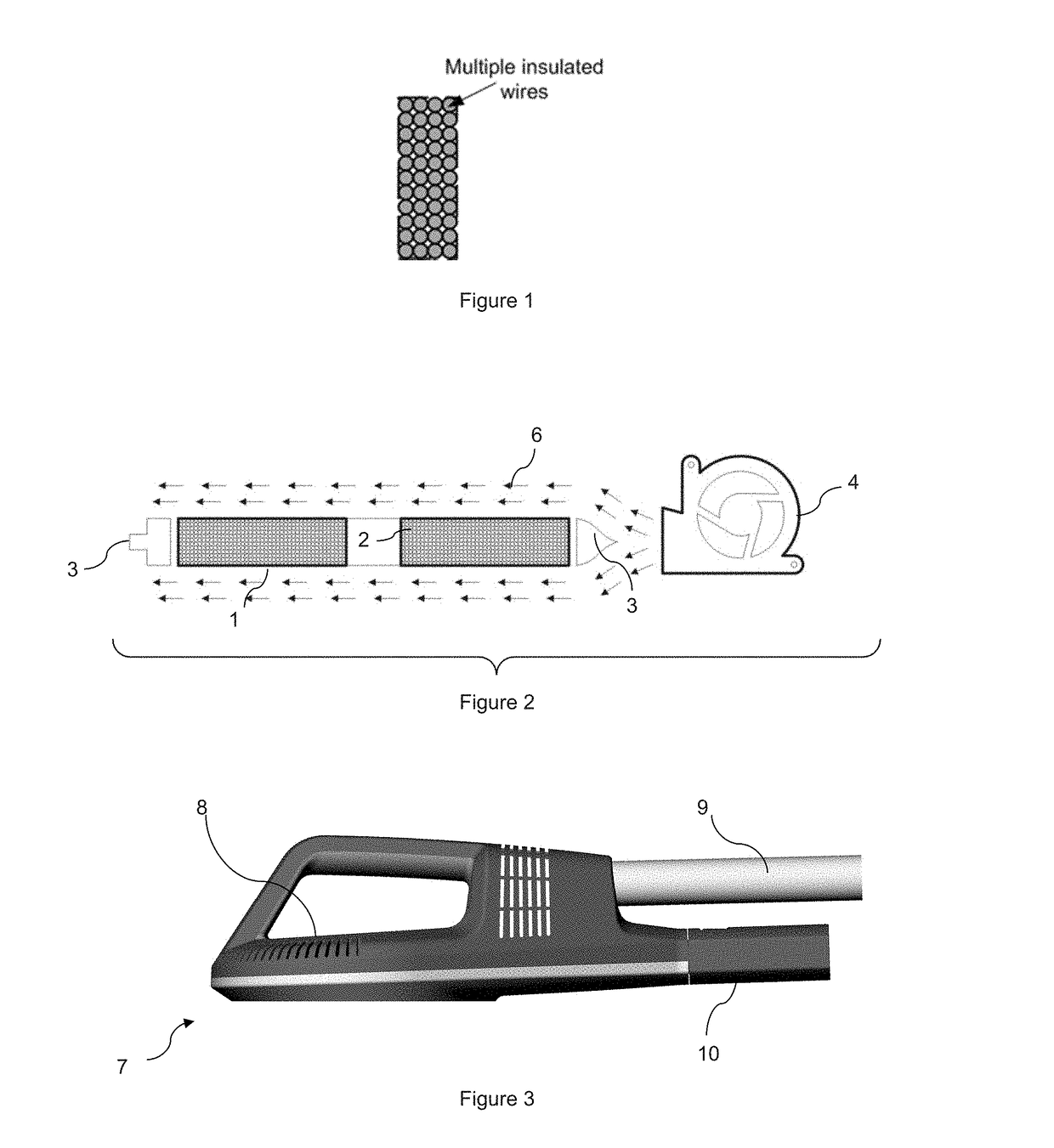

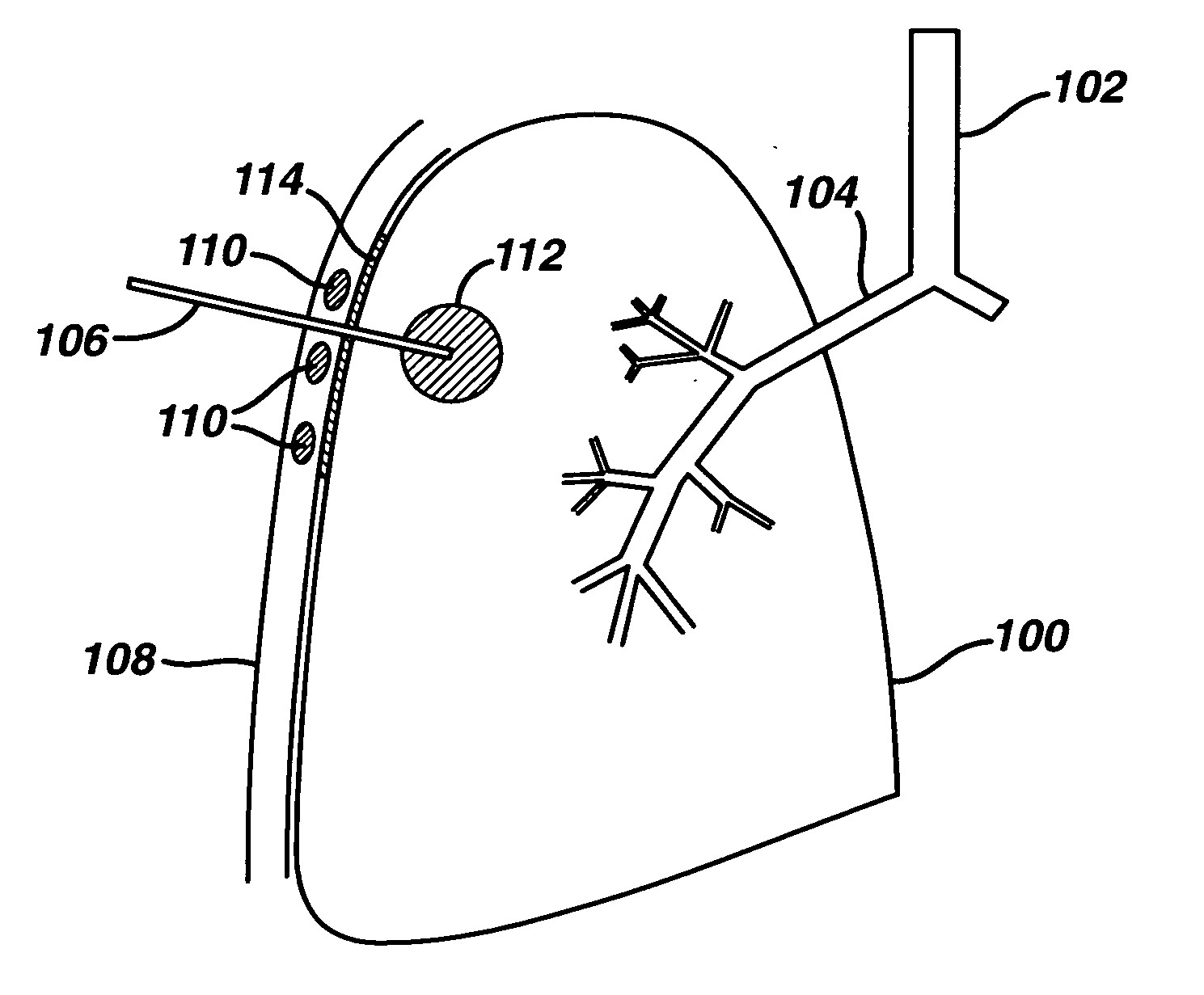

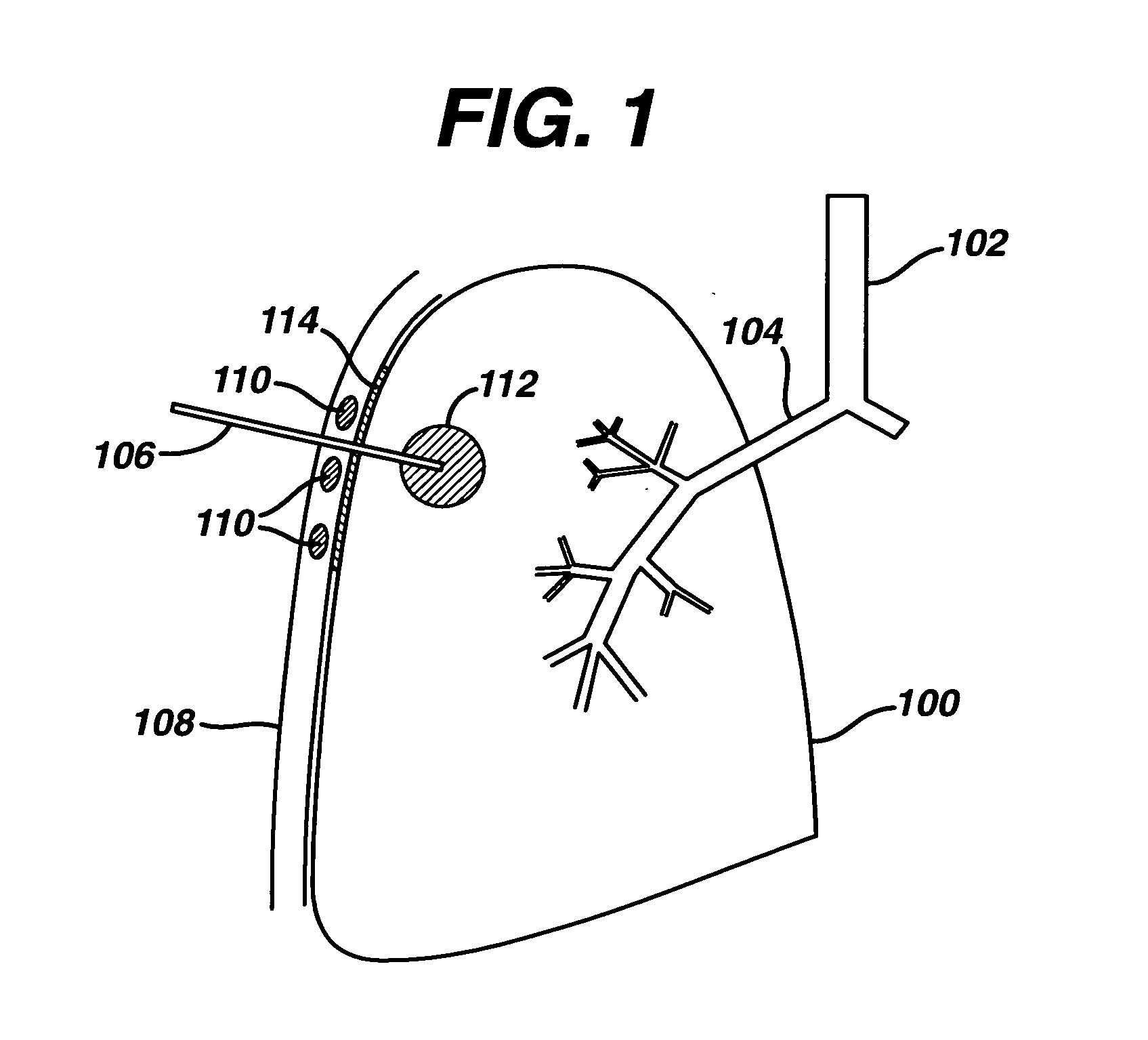

Pulmonary drug delivery

The local delivery of therapeutic agents directly into the lungs provides a methodology for safely and effectively treating various disease conditions.

Owner:PORTAERO

Method of presenting feedback to user of chances of password cracking, as the password is being created

InactiveUS20080307235A1Improve computerImprove documentUser identity/authority verificationMultiple digital computer combinationsPasswordDocumentation

A method, system and computer program product for automatically displaying the potential risk associated with cracking a password. While creating or modifying a password, feedback is provided describing the risk associated with cracking the password. Risk assessment may be presented as a percentage, accompanied by an explanation of why the value was ascertained. Risk feedback during password creation provides an opportunity to improve computer, document, and file security.

Owner:IBM CORP

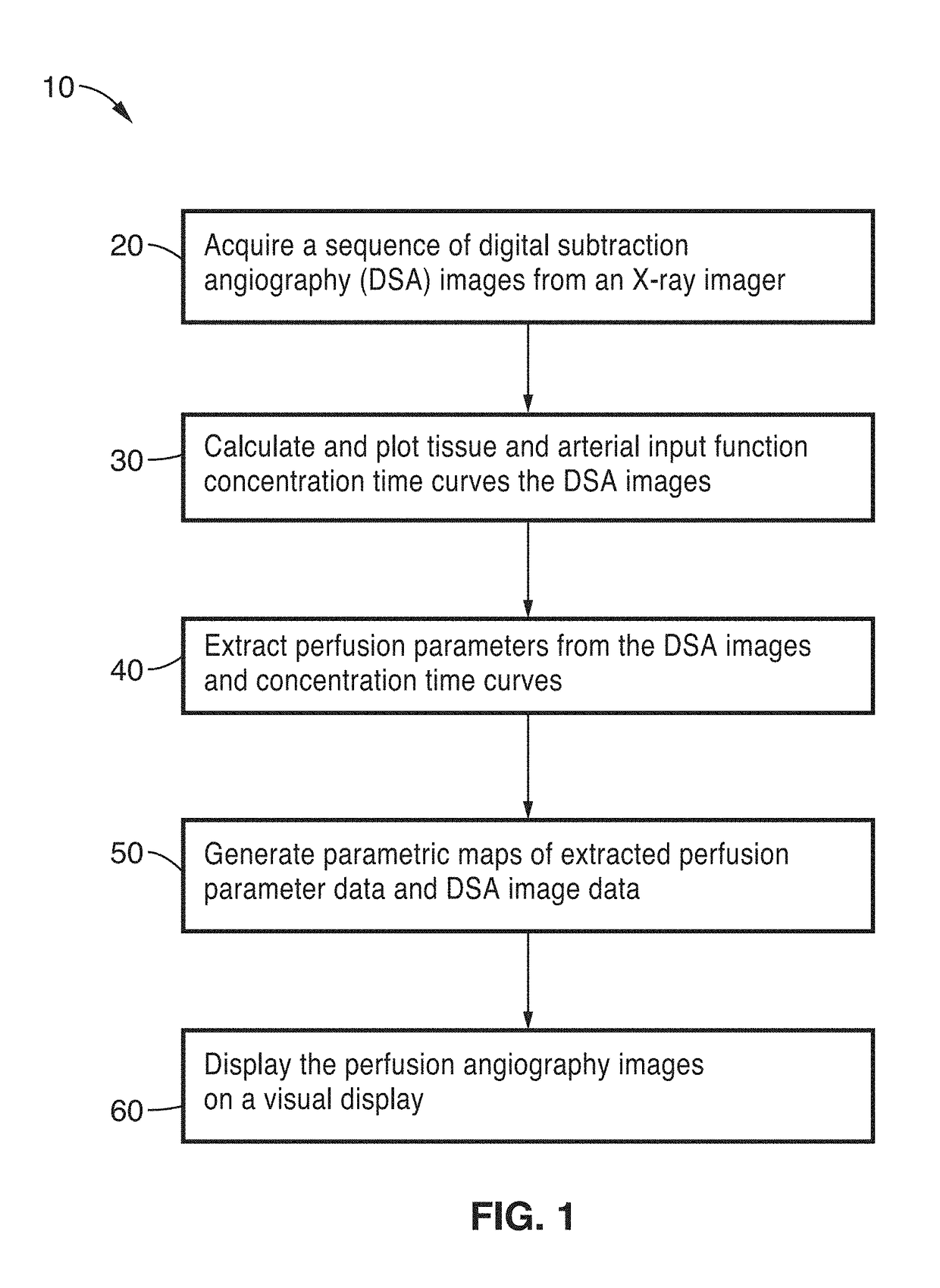

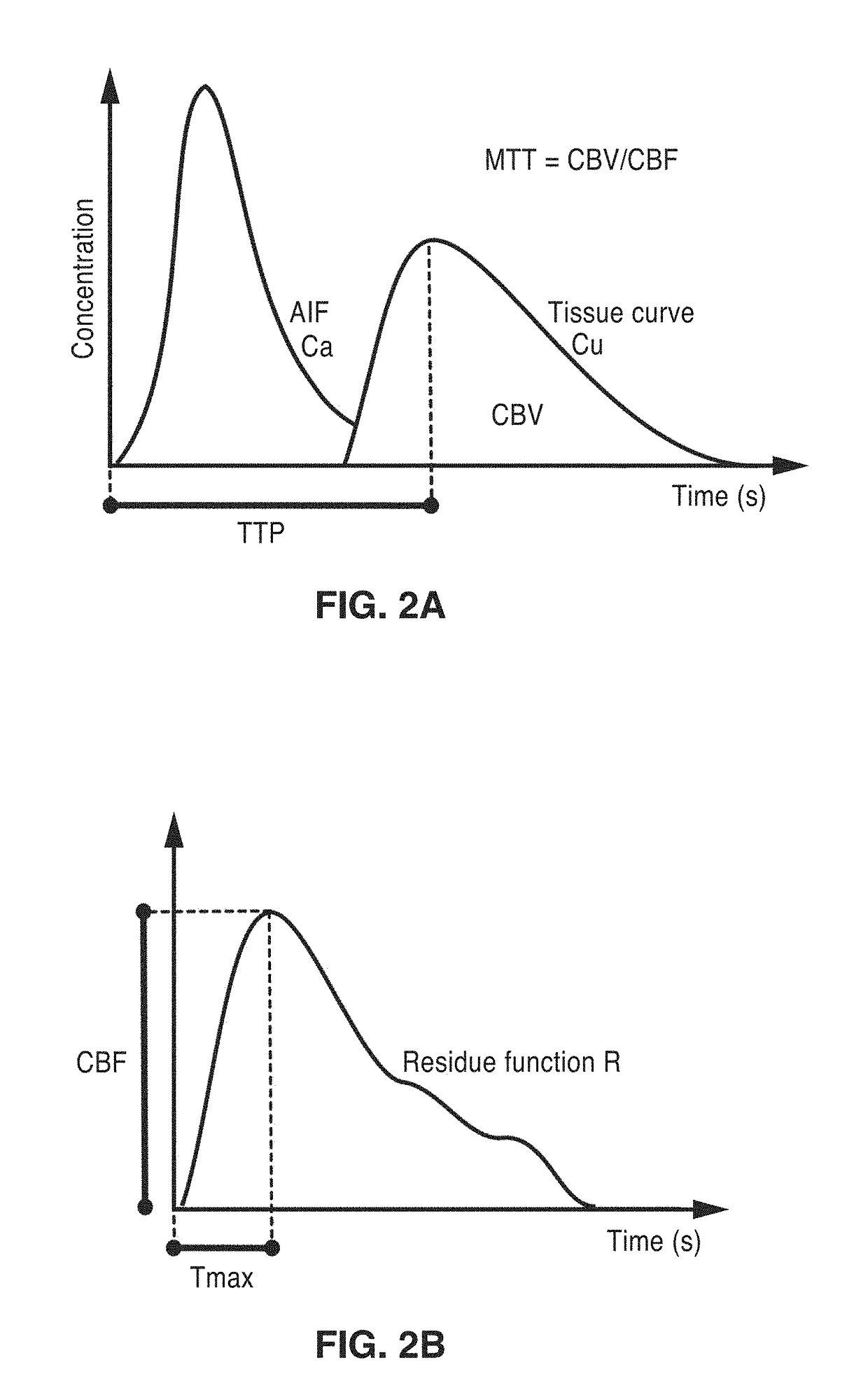

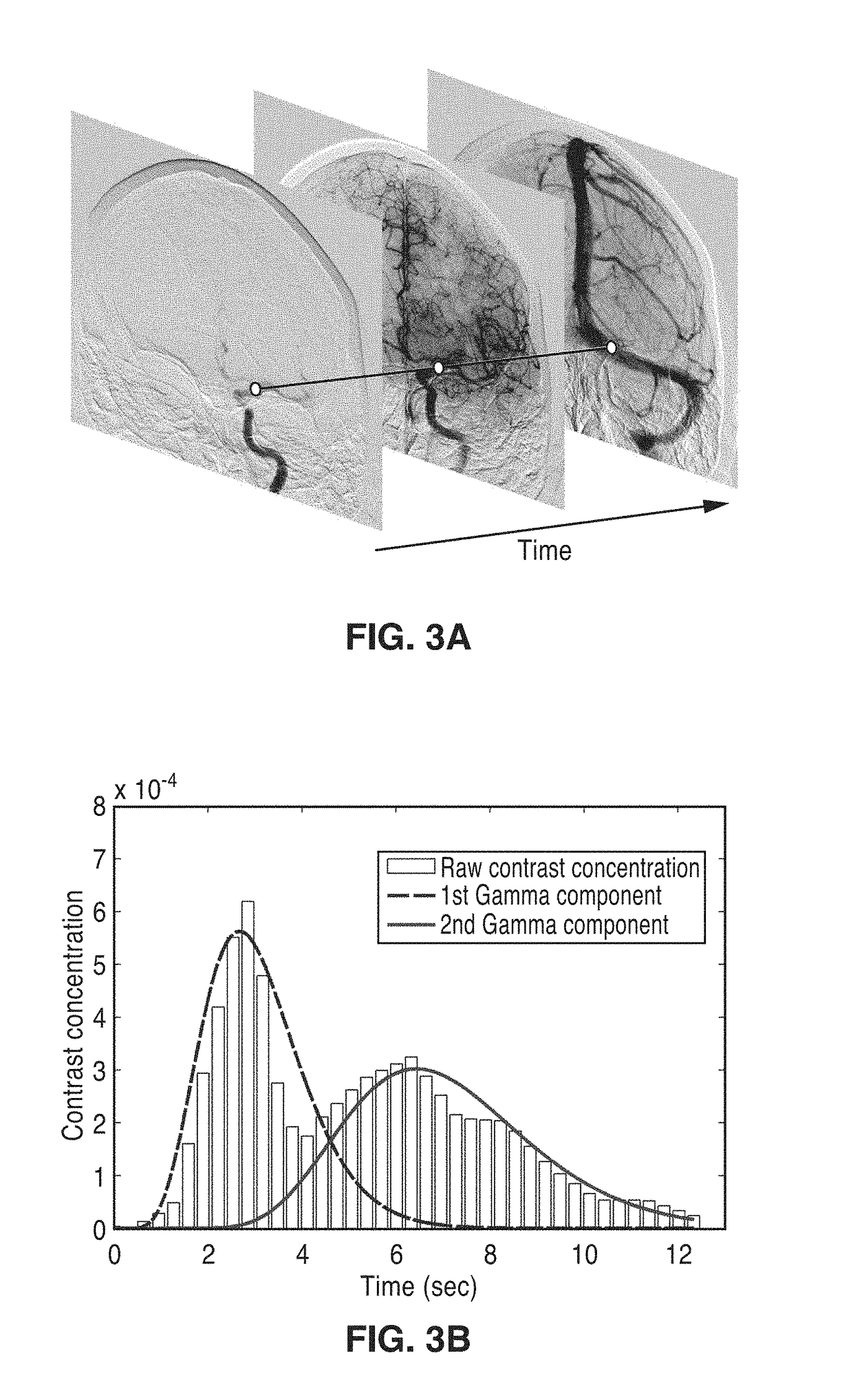

Perfusion digital subtraction angiography

ActiveUS20190015061A1Improve patient outcomesSustain viabilityImage enhancementImage analysisTime density curveVolumetric Mass Density

An apparatus and methodological framework are provided, named perfusion angiography, for the quantitative analysis and visualization of blood flow parameters from DSA images. The parameters, including cerebral blood flow (CBF) and cerebral blood volume (CBV), mean transit time (MTT), time-to-peak (TTP), and Tmax, are computed using a bolus tracking method based on the deconvolution of time-density curves on a pixel-by-pixel basis. Individual contrast concentration curves of overlapping vessels can be delineated with multivariate Gamma fitting. The extracted parameters are each transformed into parametric maps of the target that can be color coded with different colors to represent parameter values within a particular set range. Side by side parametric maps with corresponding DSA images allow expert evaluation and condition diagnosis.

Owner:RGT UNIV OF CALIFORNIA

Ergonomic, lighted uterine manipulator with cautery

ActiveUS8603105B2Easy to learnEasy to installDiagnosticsSurgical instrument detailsEngineeringUterine manipulator

A uterine manipulator includes a sound and a body. The sound has a selectively actuatable anchor disposed proximate a distal end and an operating mechanism spaced from the anchor for controlling actuation of the anchor. The body has a passage therethrough adapted to receive the sound passed proximally through the body to a position in which the operating mechanism is accessible proximally of the body and the anchor extends distally.

Owner:LSI SOLUTIONS

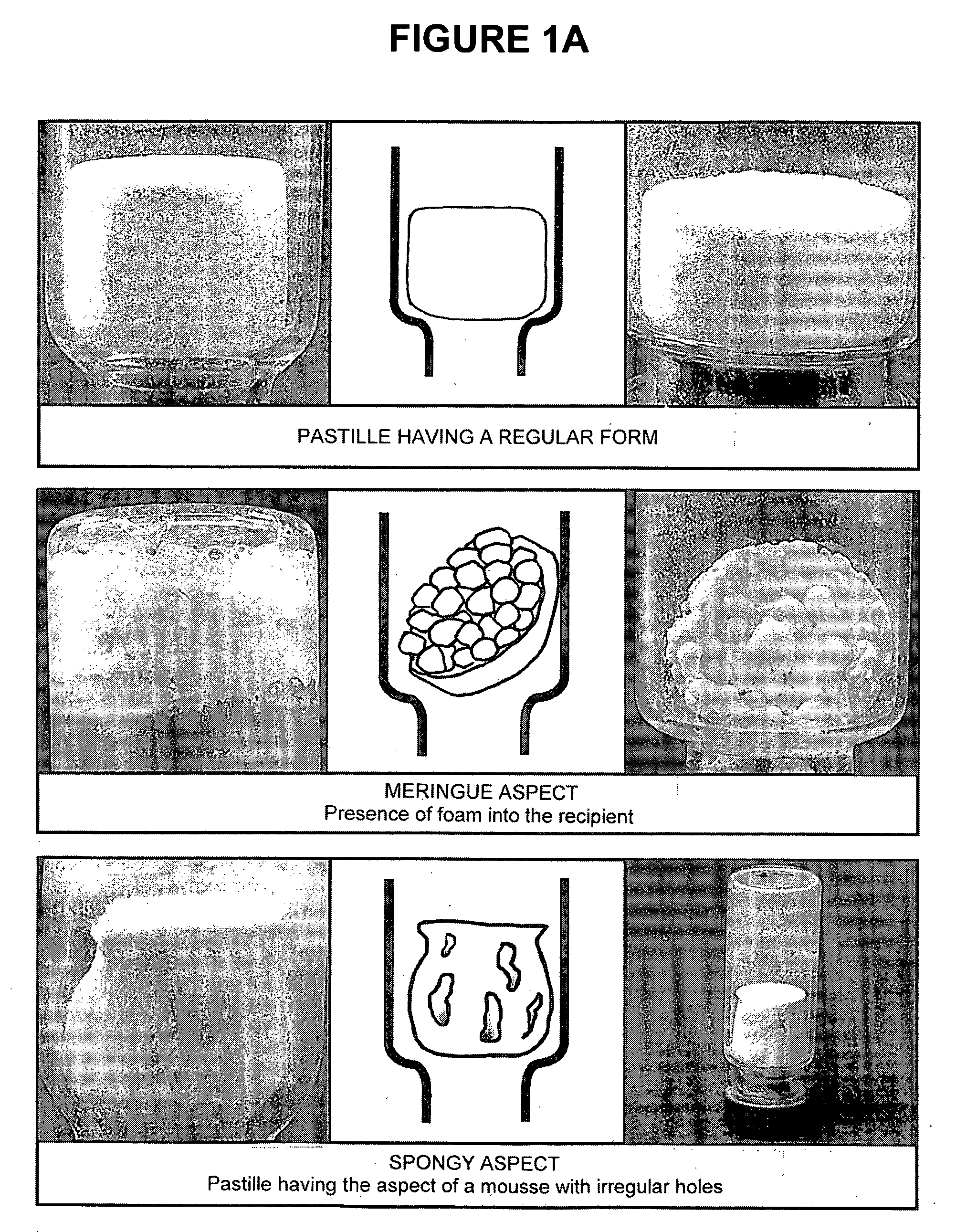

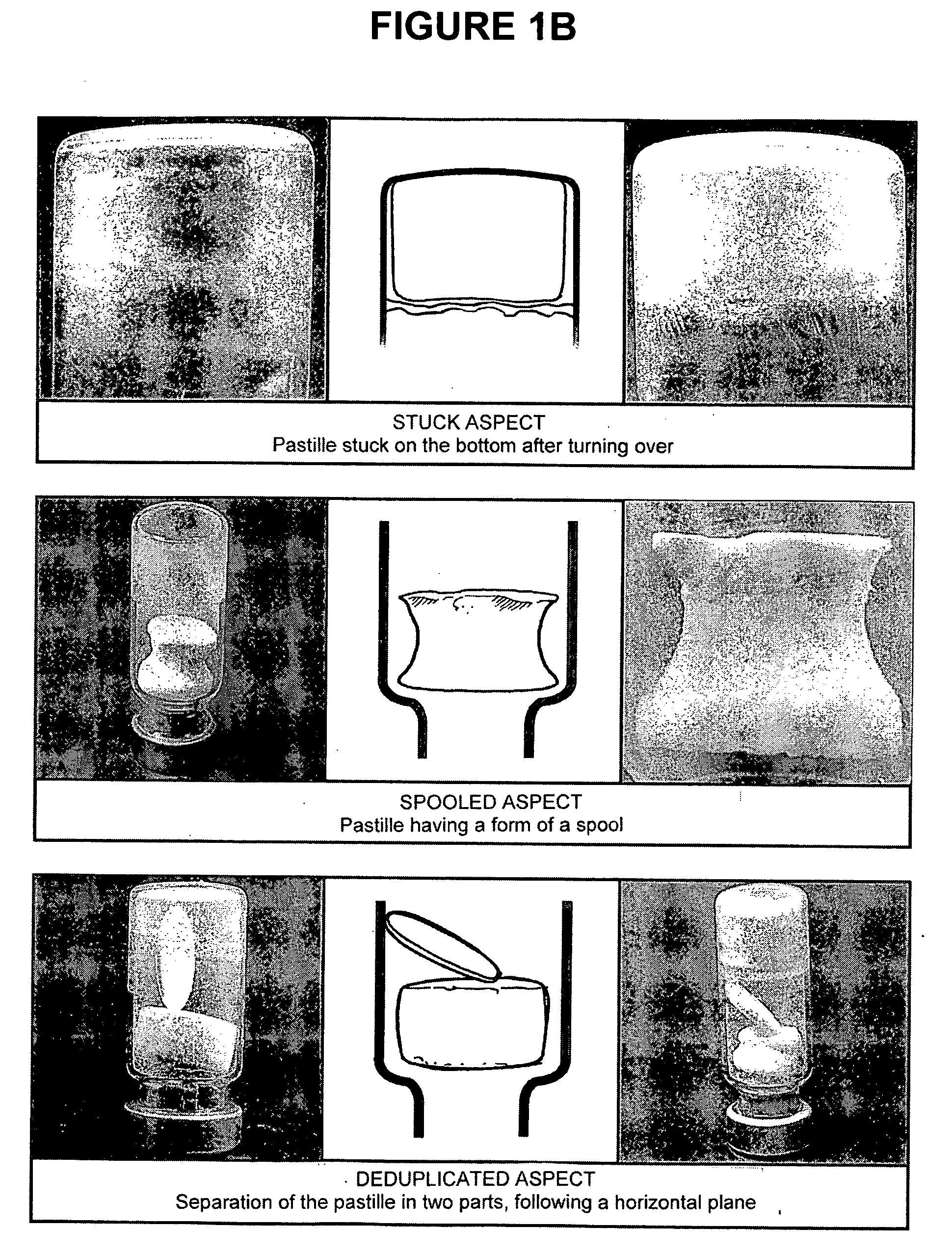

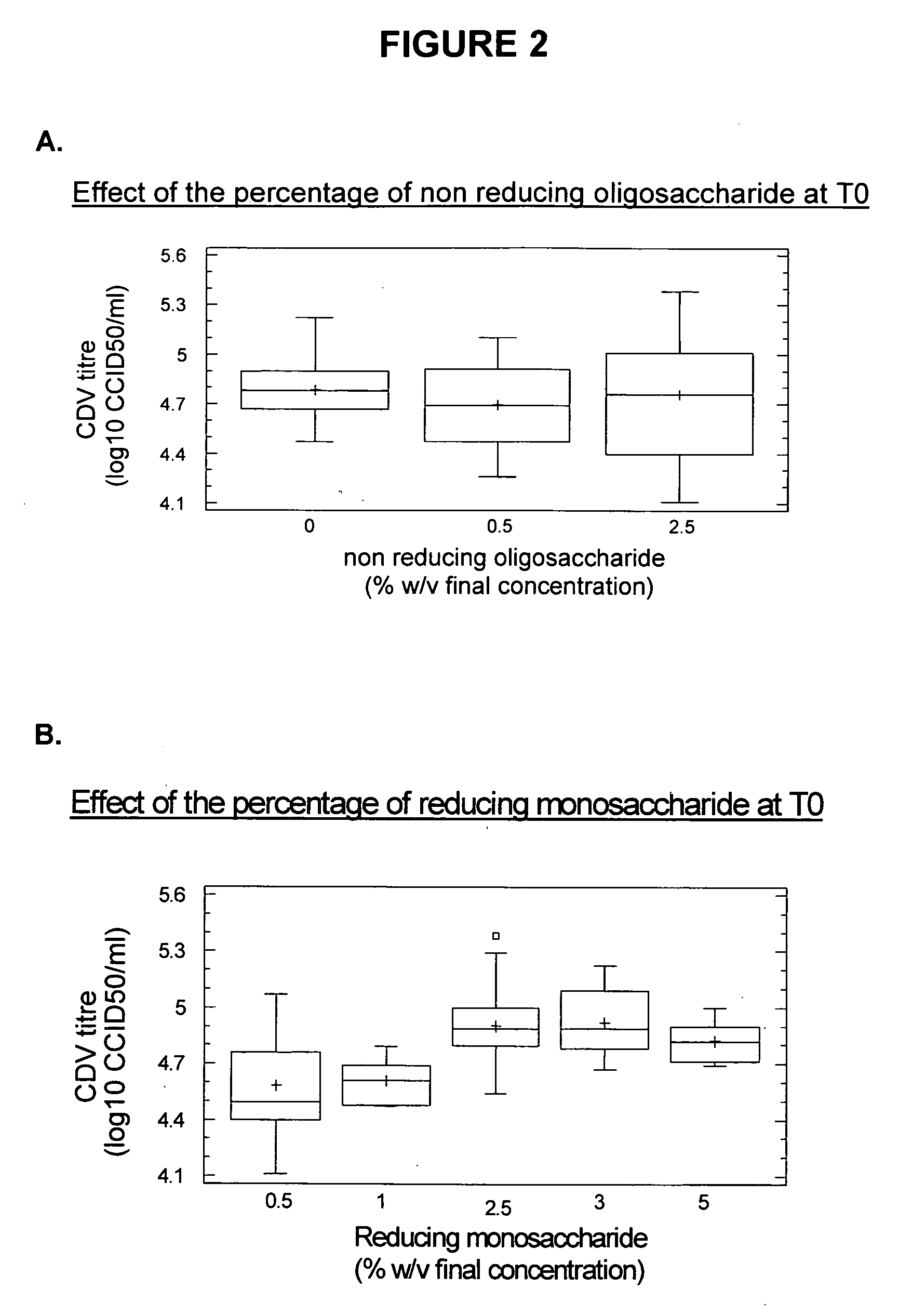

Stabilizers for freeze-dried vaccines

ActiveUS20100260796A1Preserve viability and infectivityMinimized and eliminatedSsRNA viruses negative-senseViral antigen ingredientsImmunogenicityTGE VACCINE

The present invention relates generally to the fields of immunology and vaccine technology. More specifically, the present invention relates to stabilizers for freeze-dried live attenuated immunogenic and / or vaccine compositions, which may comprise, inter alia, canine paramyxovirus. The invention further relates to stabilized, freeze-dried live attenuated immunogenic and / or vaccine compositions of, for example, canine paramyxovirus, which may contain these stabilizers. Other aspects of the invention are described in or are obvious from the following disclosure, and are within the ambit of the invention.

Owner:MERIAL INC

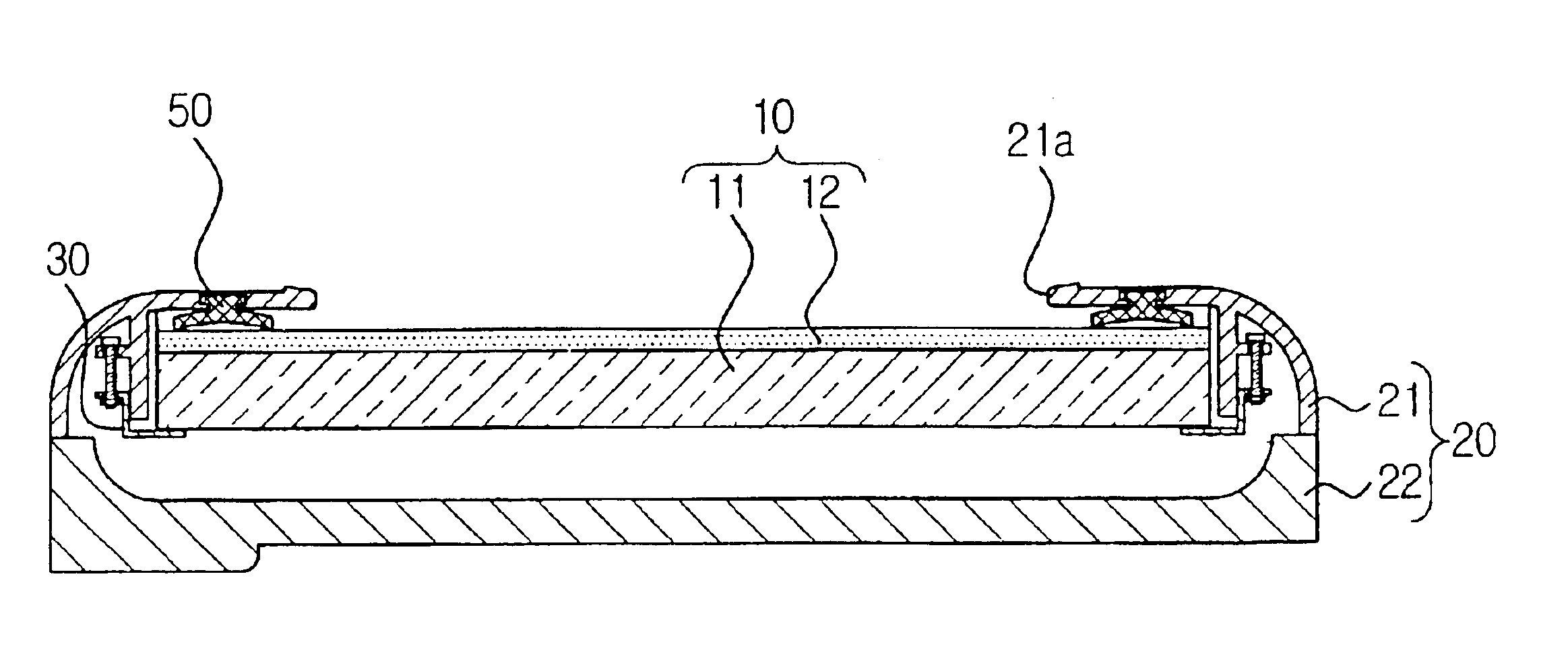

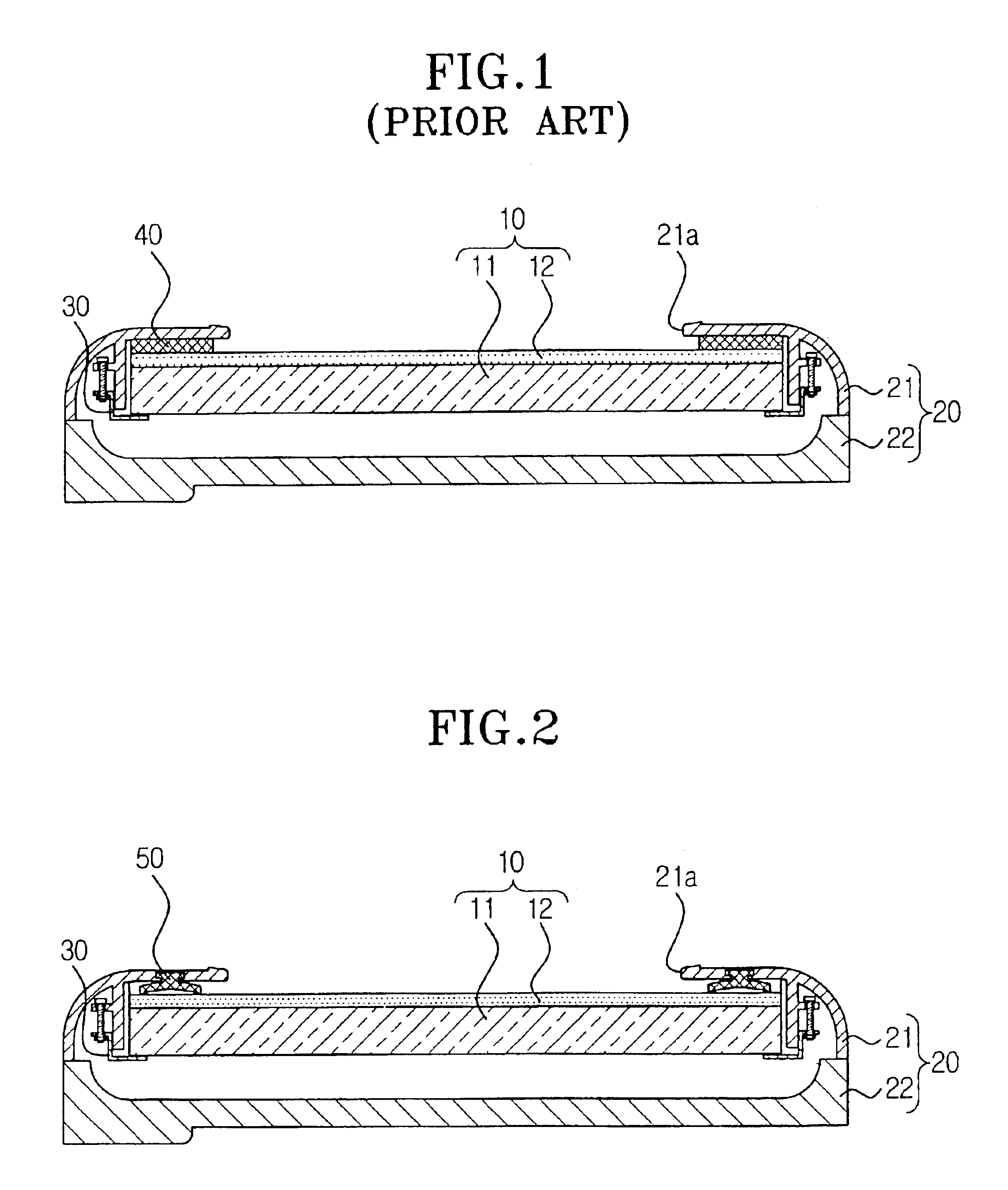

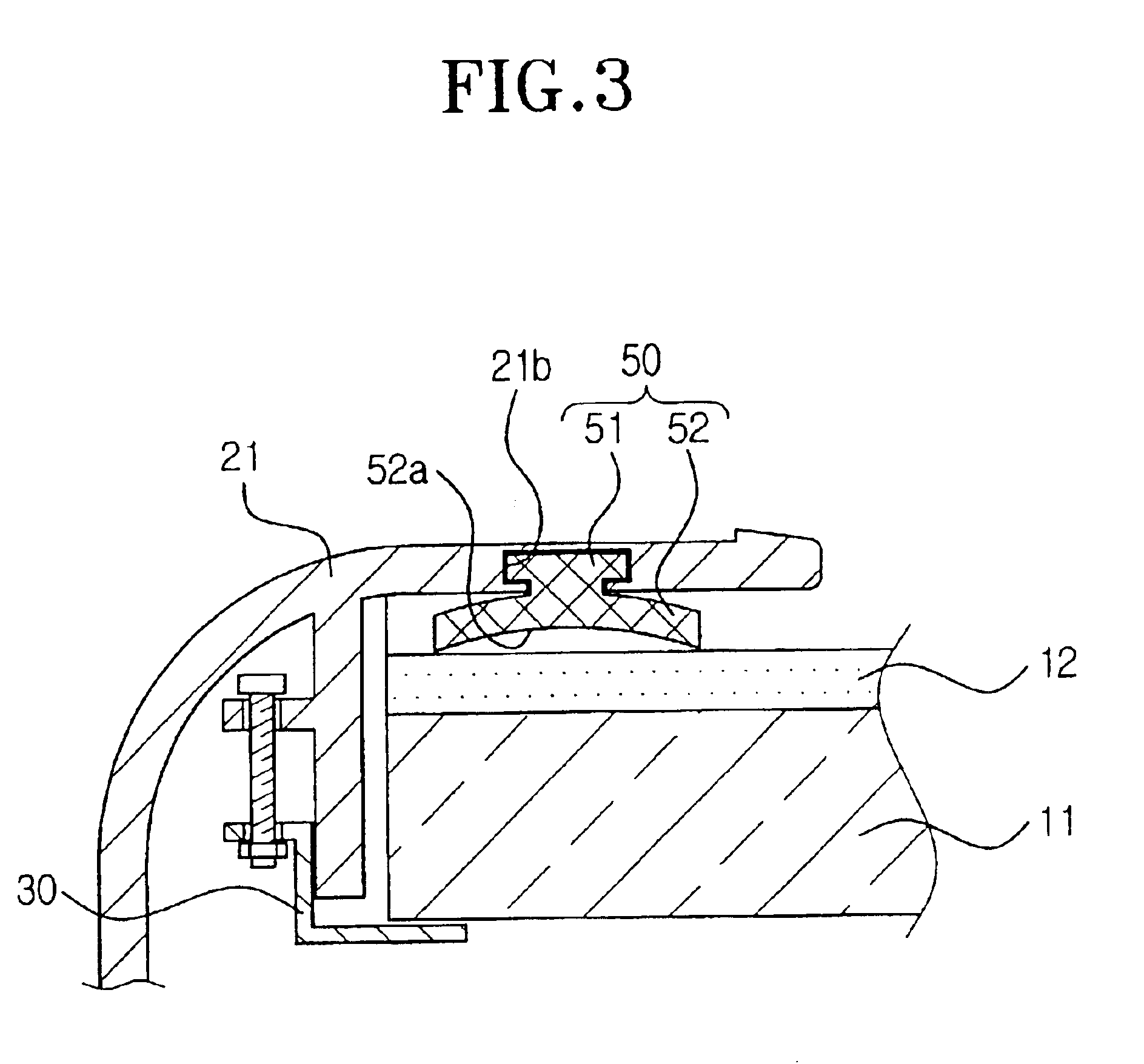

LCD assembly used with a personal digital assistant

InactiveUS6888591B2Increase elasticityExcellent in impact-absorbing capacityStatic indicating devicesDigital data processing detailsRubber materialClose contact

An LCD assembly used with a wireless information terminal including: an LCD module including an LCD and a TSP attached on a surface of the LCD; a housing having upper and lower housing members which butt against each other to be coupled in order to support the LCD module, an exposure window of a certain size being formed in the upper housing member; and a space maintaining member inserted to maintain a certain gap between a rim of the TSP of the LCD module and the upper housing member, and formed of a rubber material having excellent elasticity and impact-absorbing capacity. The space maintaining member has a fixture portion and a pad portion in close contact with the TSP, and the pad portion has an air groove allowing air to exist between the TSP and itself.

Owner:TRANSPACIFIC AVARTAR

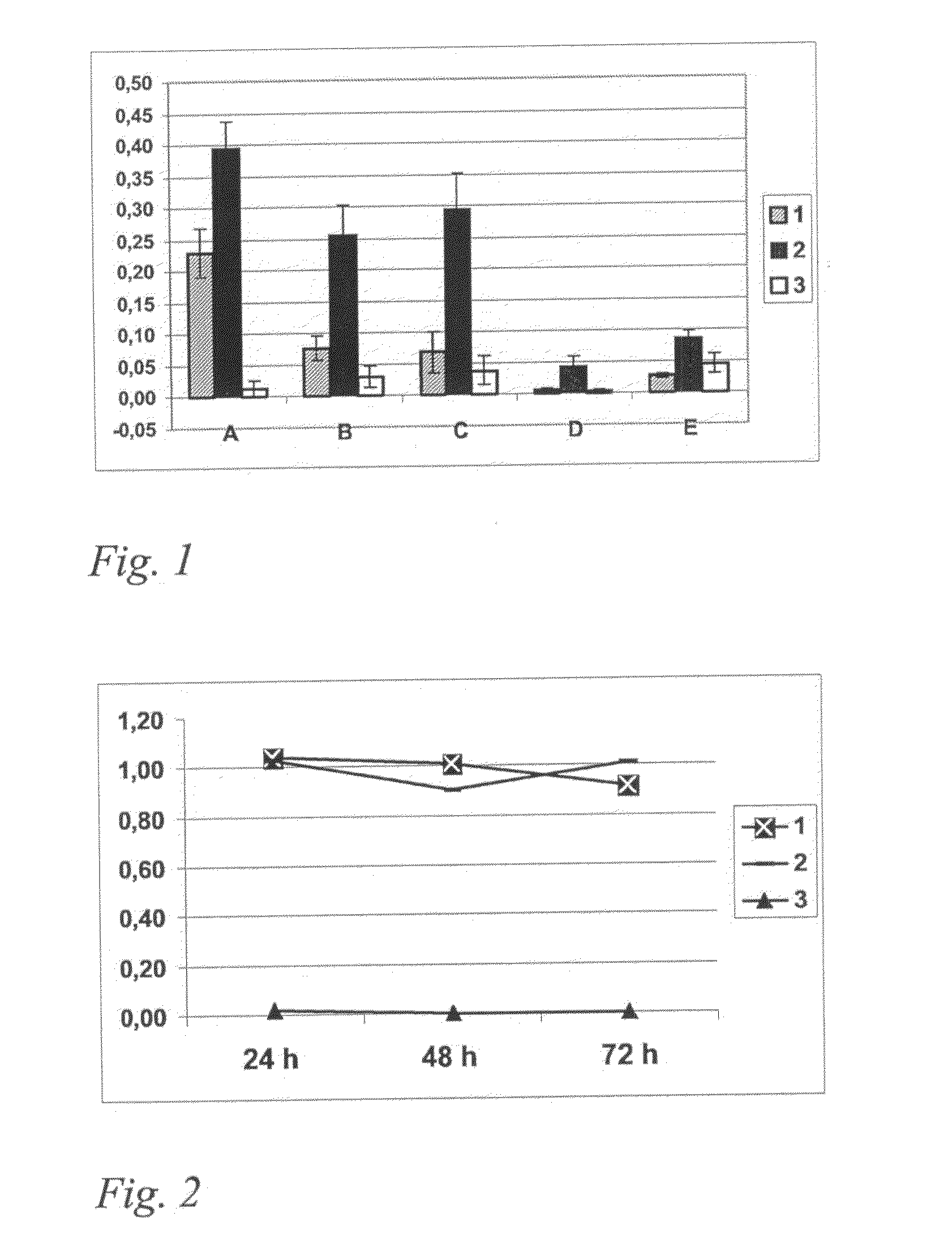

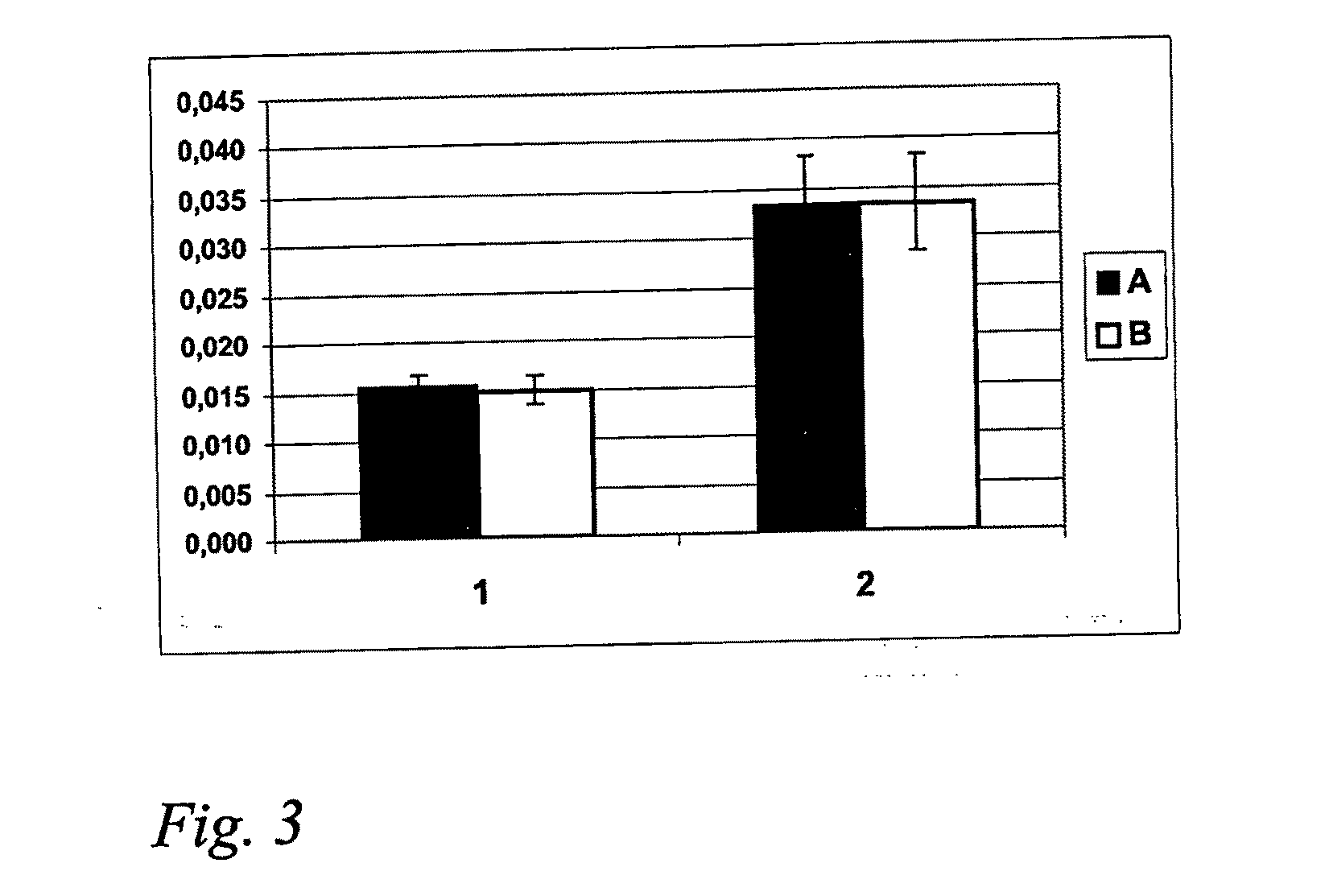

Diagnostic and therapeutic agents

InactiveUS20090180958A1Highly selective and potent targetingPotential riskTetrapeptide ingredientsCyclic peptide ingredientsDiseaseTumor target

The present invention relates to tumor targeting units comprising a peptide sequence X—R—Y—P—Zn, or a pharmaceutically or physiologically acceptable salt thereof. The invention further relates to tumor targeting agents comprising at least one targeting unit according to the present invention, directly or indirectly coupled to at least one effector unit. The present invention further relates to diagnostic or pharmaceutical compositions comprising at least one targeting unit or at least one targeting agent according to the present invention, and to the use of targeting units or targeting agents according to the present invention for the preparation of a medicament for the treatment of cancer or cancer related diseases, especially for the treatment of non-small cell lung cancer or its metastases.

Owner:KARYON CTT

Aesthetic method of biological structure treatment by magnetic field

ActiveUS10709895B2Muscle strengtheningGood treatment effectElectrotherapyMagnetotherapy using coils/electromagnetsVisual appearanceVisual perception

Combined methods for treating a patient using time-varying magnetic field are described. The treatment methods combine various approaches for aesthetic treatment. The methods are focused on enhancing a visual appearance of the patient.

Owner:BTL MEDICAL SOLUTIONS AS

Aesthetic method of biological structure treatment by magnetic field

ActiveUS20200054890A1Muscle strengtheningGood treatment effectUltrasound therapyElectrotherapyVisual appearanceVisual perception

Combined methods for treating a patient using time-varying magnetic field are described. The treatment methods combine various approaches for aesthetic treatment. The methods are focused on enhancing a visual appearance of the patient.

Owner:BTL MEDICAL SOLUTIONS AS

Aesthetic method of biological structure treatment by magnetic field

ActiveUS10821295B1Muscle strengtheningGood treatment effectUltrasound therapyElectrotherapyVisual appearanceVisual perception

Combined methods for treating a patient using time-varying magnetic field are described. The treatment methods combine various approaches for aesthetic treatment. The methods are focused on enhancing a visual appearance of the patient.

Owner:BTL MEDICAL SOLUTIONS AS

Aesthetic method of biological structure treatment by magnetic field

ActiveUS10556122B1Muscle strengtheningGood treatment effectUltrasound therapyElectrotherapyVisual appearanceVisual perception

Combined methods for treating a patient using time-varying magnetic field are described. The treatment methods combine various approaches for aesthetic treatment. The methods are focused on enhancing a visual appearance of the patient.

Owner:BTL MEDICAL SOLUTIONS AS

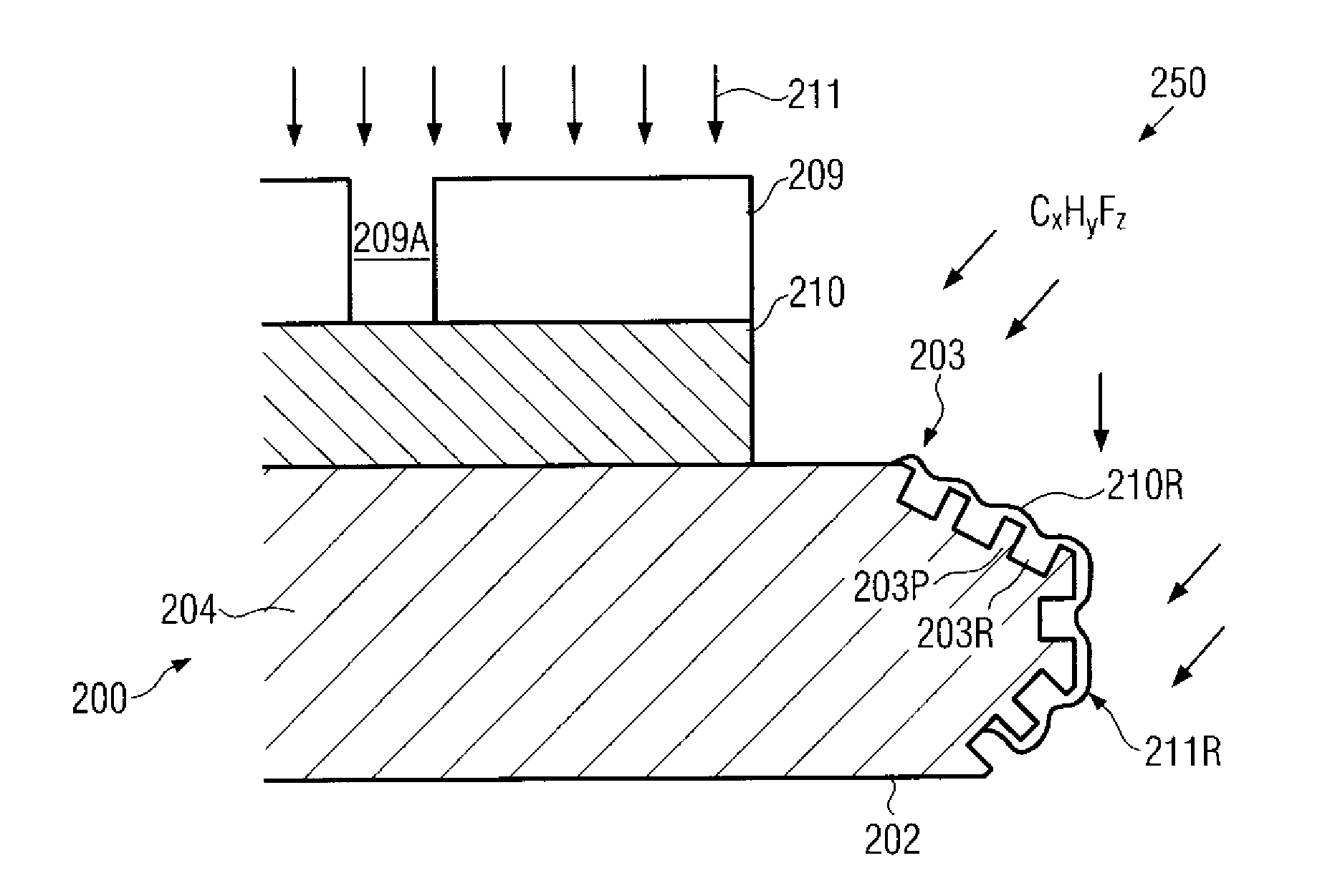

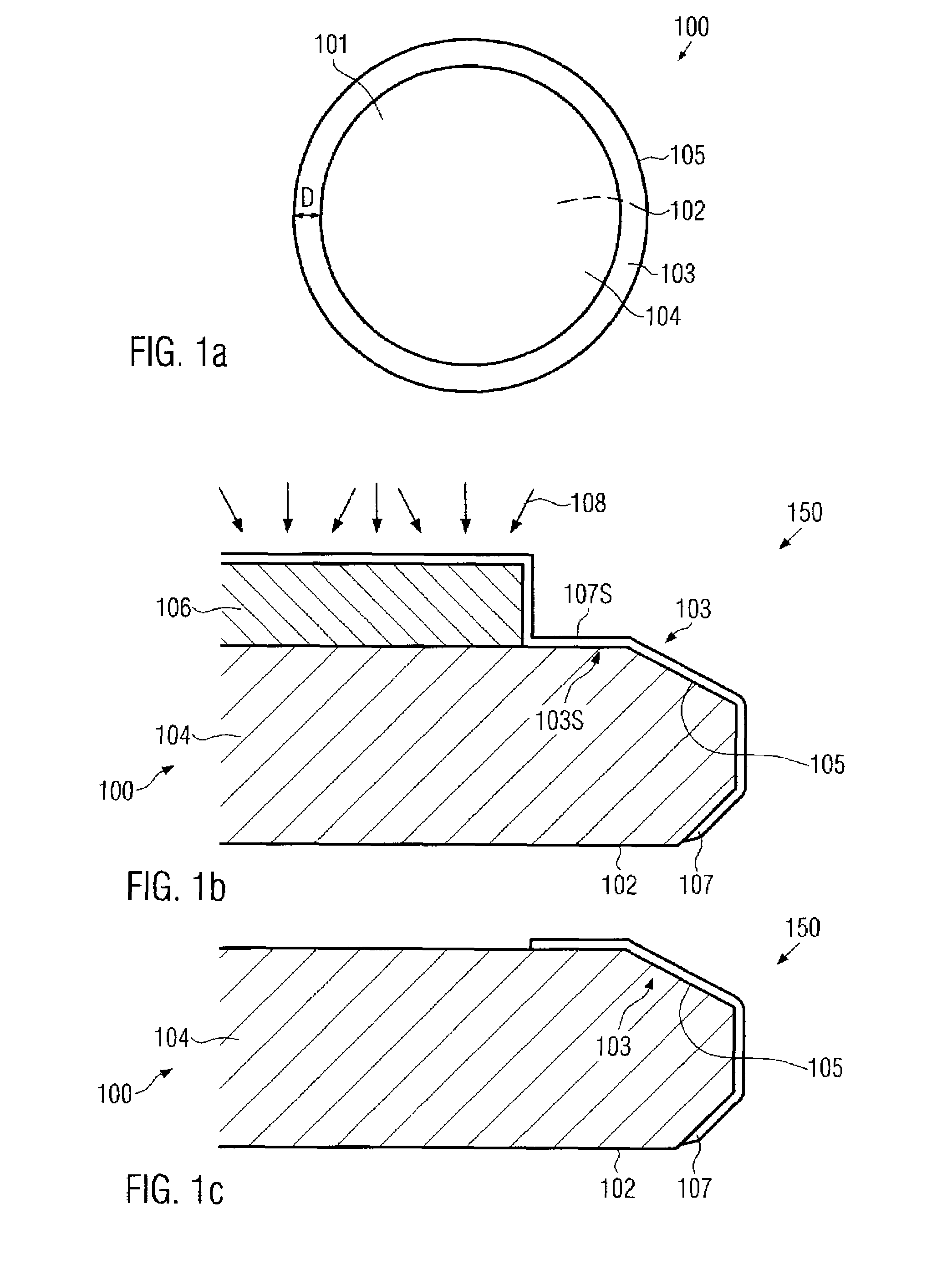

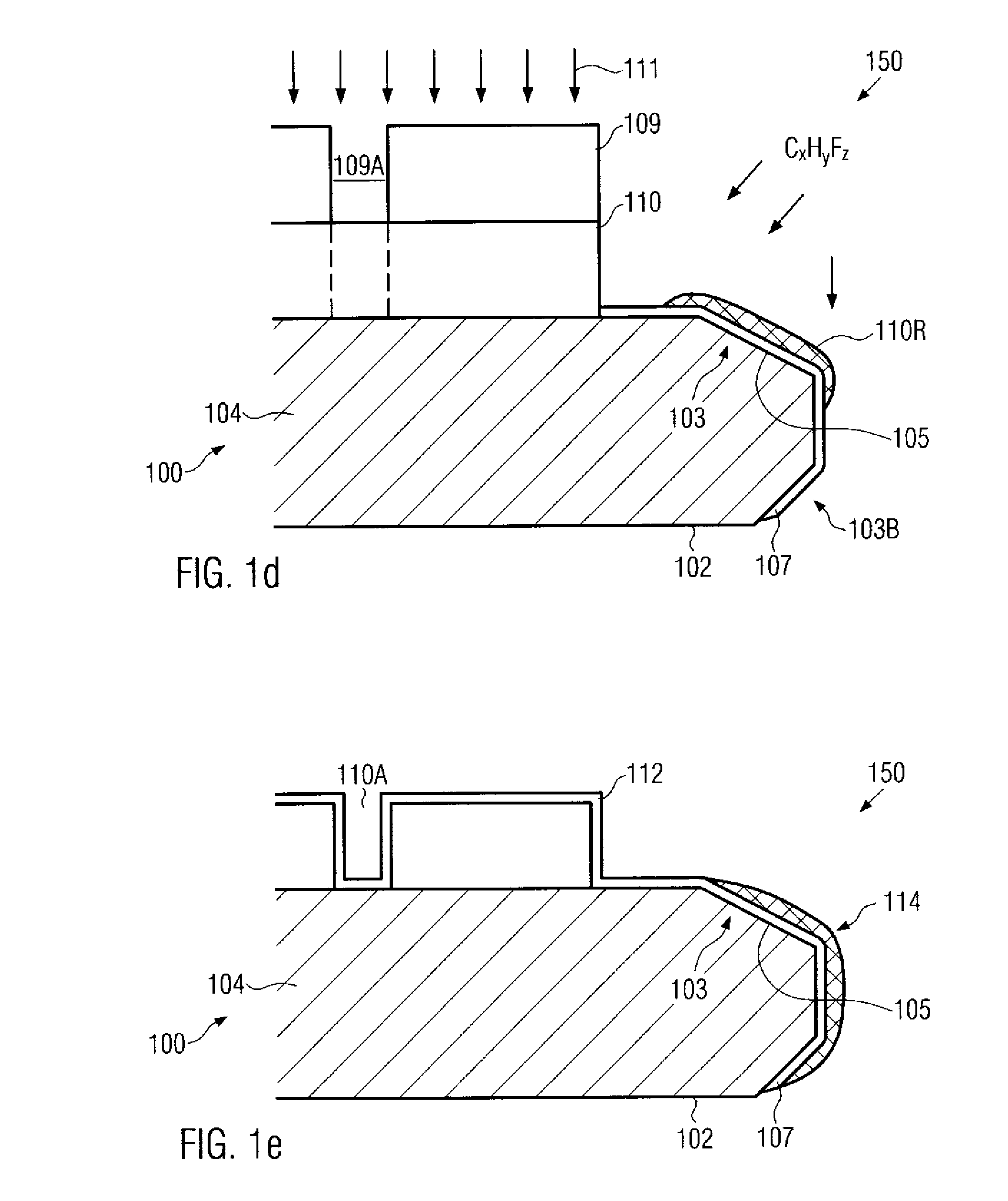

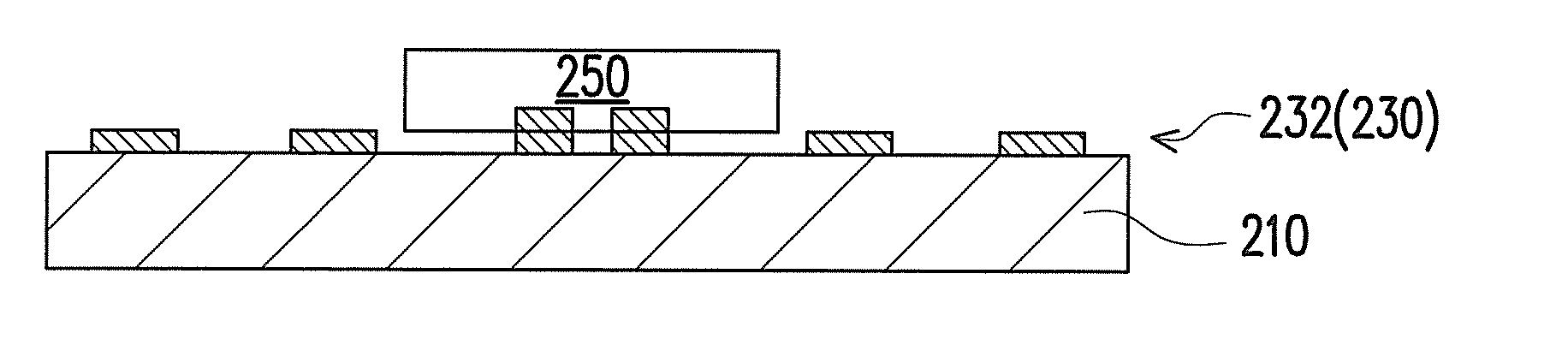

Reducing contamination of semiconductor substrates during beol processing by providing a protection layer at the substrate edge

ActiveUS20080003830A1Reduce probabilityIncrease surface areaSemiconductor/solid-state device manufacturingEngineeringProtection layer

By providing a protection layer at the bevel region, the deposition of polymer materials during the patterning process of complex metallization structures may be reduced. Additionally or alternatively, a surface topography may be provided, for instance in the form of respective recesses, in order to enhance the degree of adhesion of any materials deposited in the bevel region during the manufacturing of complex metallization structures. Advantageously, the provision of the protection layer providing the reduced polymer deposition may be combined with the modified surface topography.

Owner:ADVANCED MICRO DEVICES INC

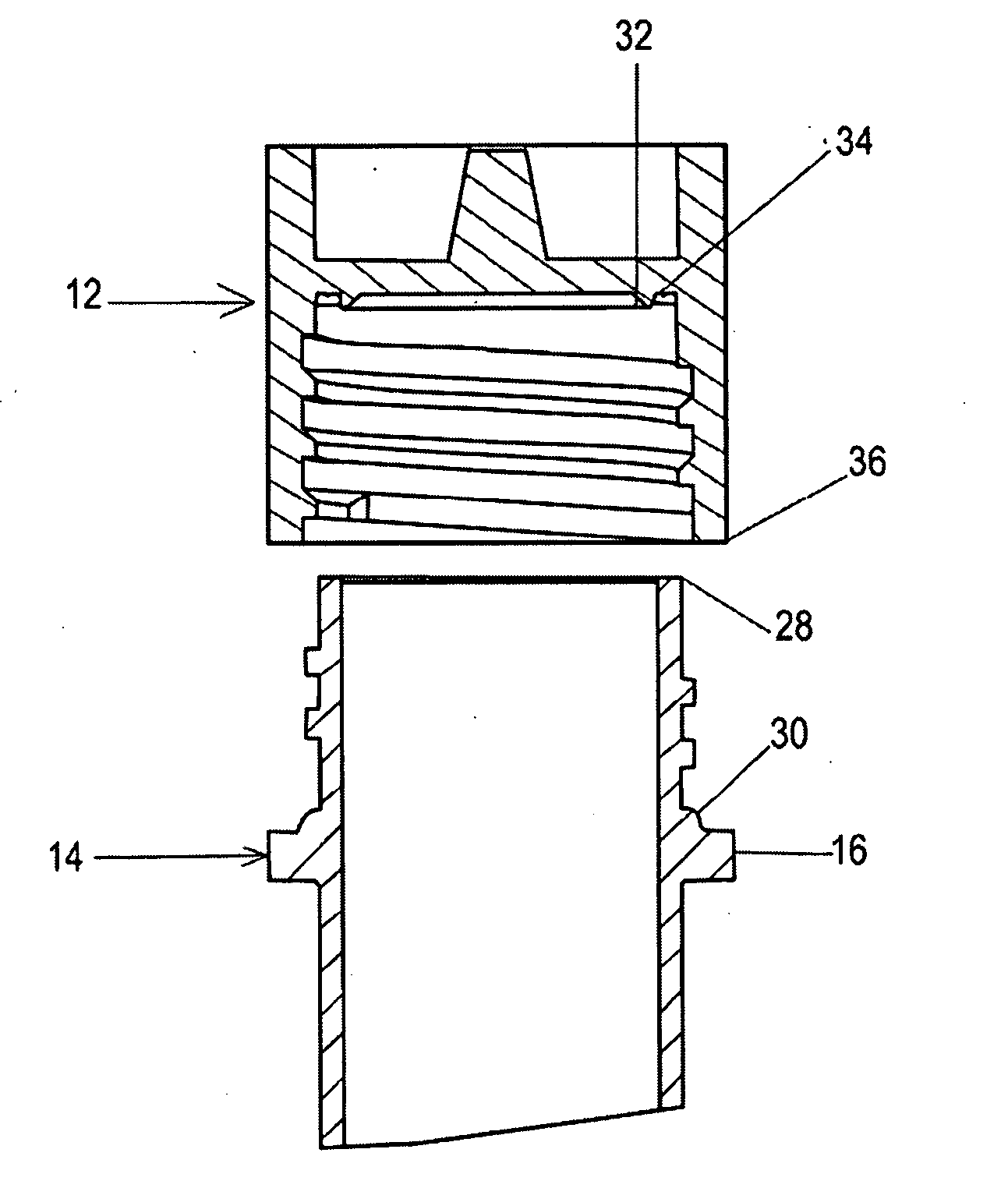

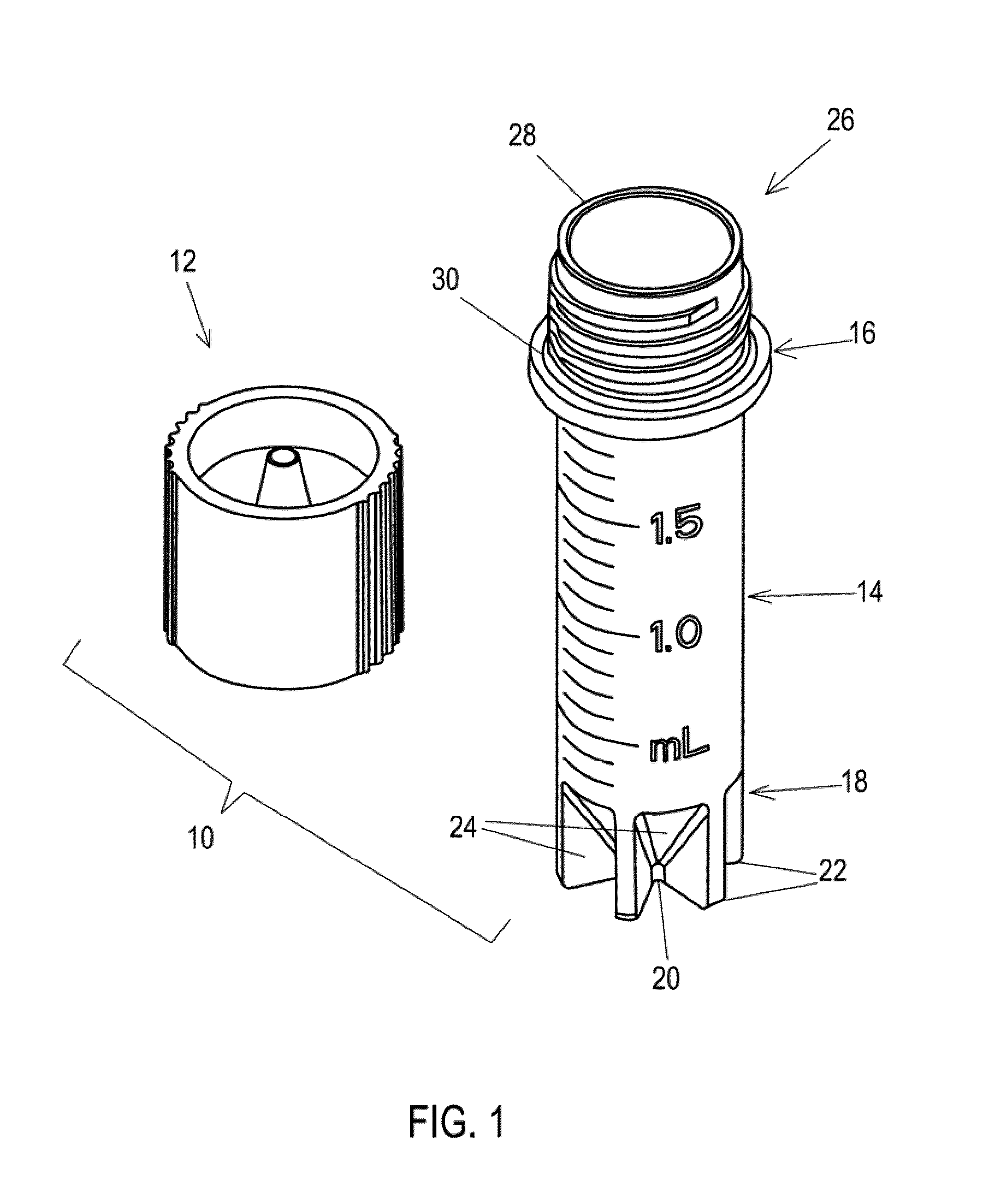

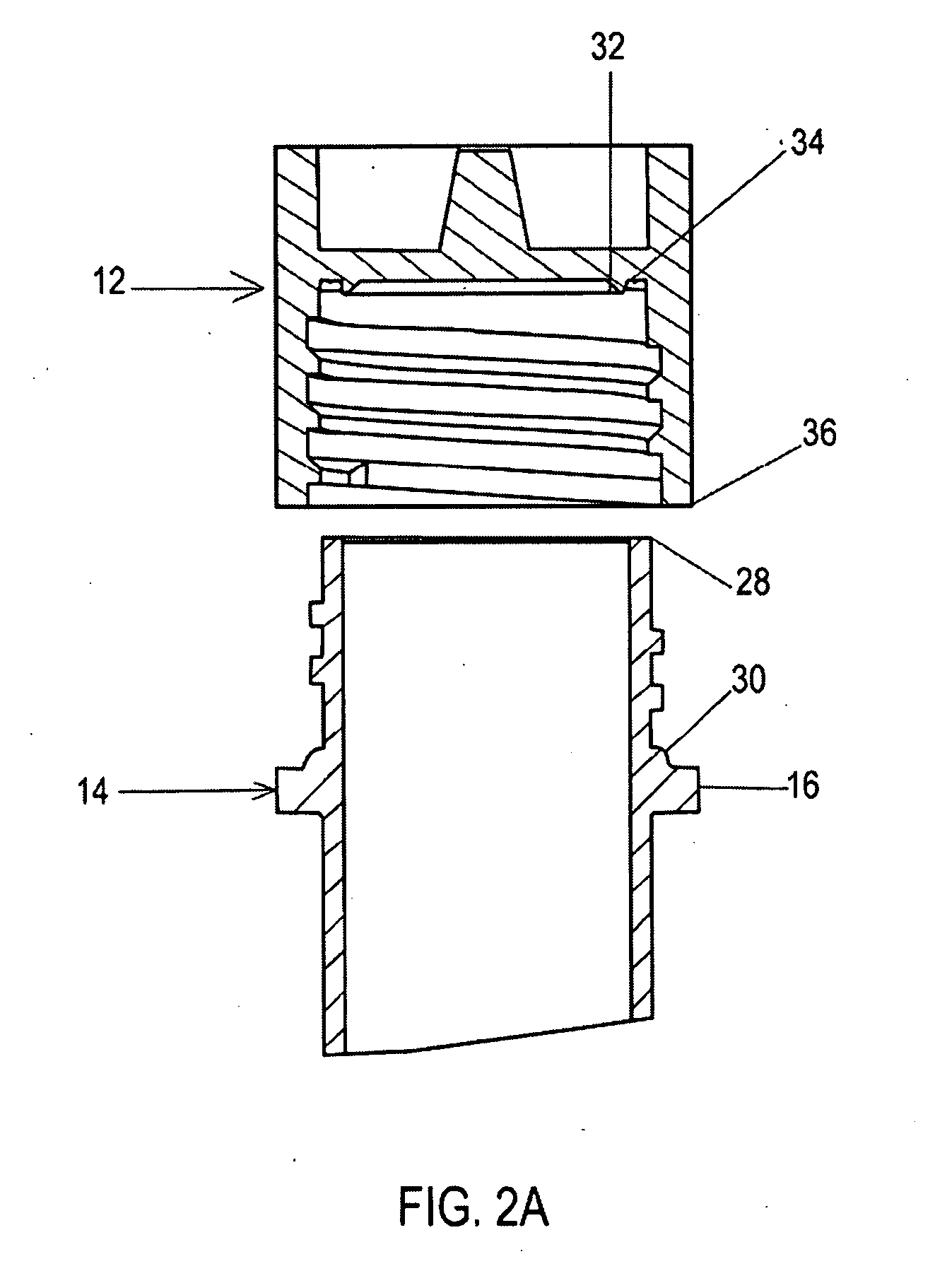

Cryogenic storage container

InactiveUS20090255938A1Prevent spillageAvoid contaminationCapsContainer filling methodsWarming rateCryopreservation

A cryopreservation storage and processing container for cryogenic material is disclosed. In one embodiment, the container can be used to cryopreserve and store biological specimens at cryogenic temperature but also can be used directly in centrifuges or microcentrifuges to process biological materials. It incorporates the functions of both storage container and centrifuge tubes, provides self-sealing mechanism, and accommodates higher cooling / warming rates. The storage container includes both a vessel body 14 and a cap 12.

Owner:FUJA TANNIN J

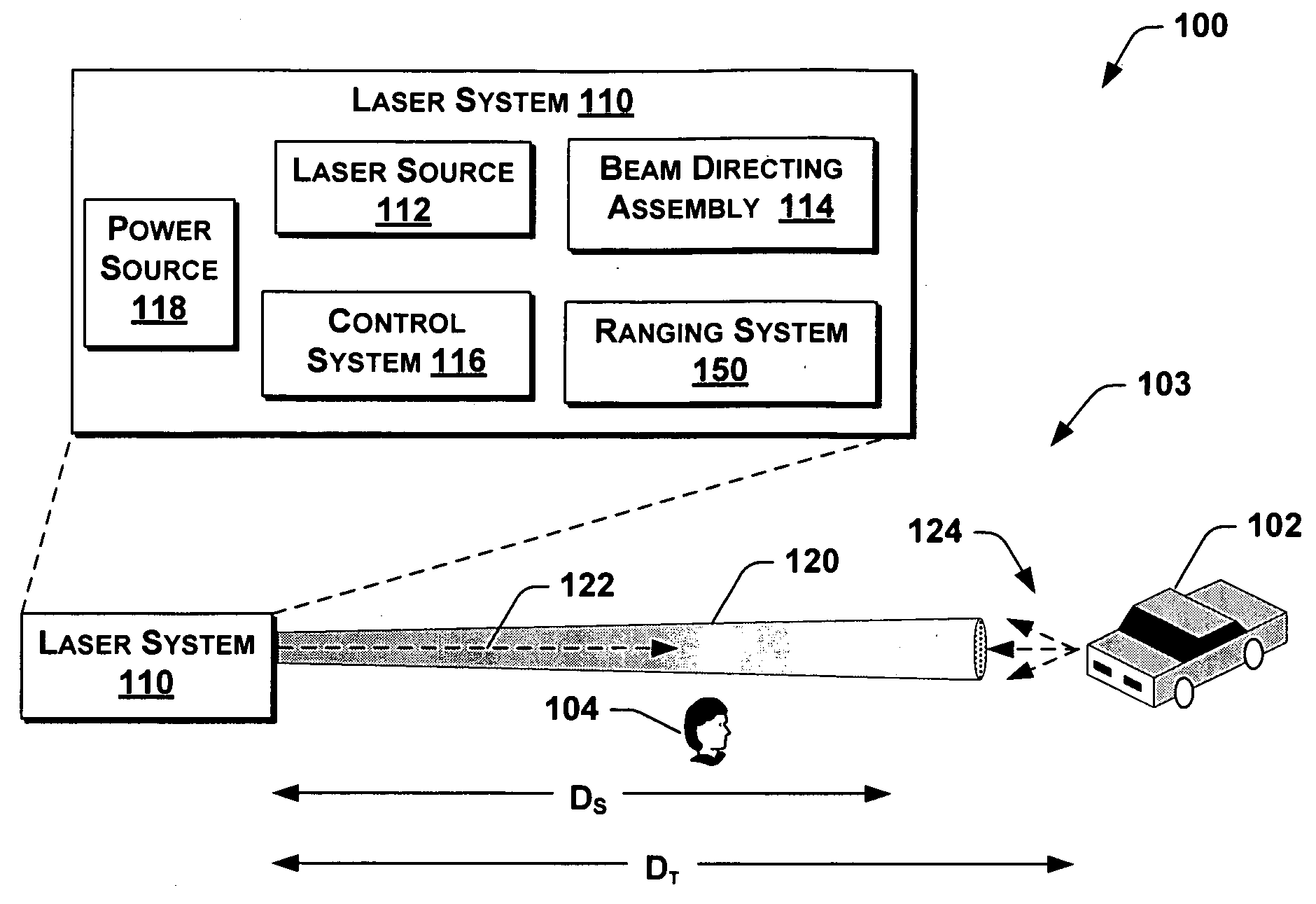

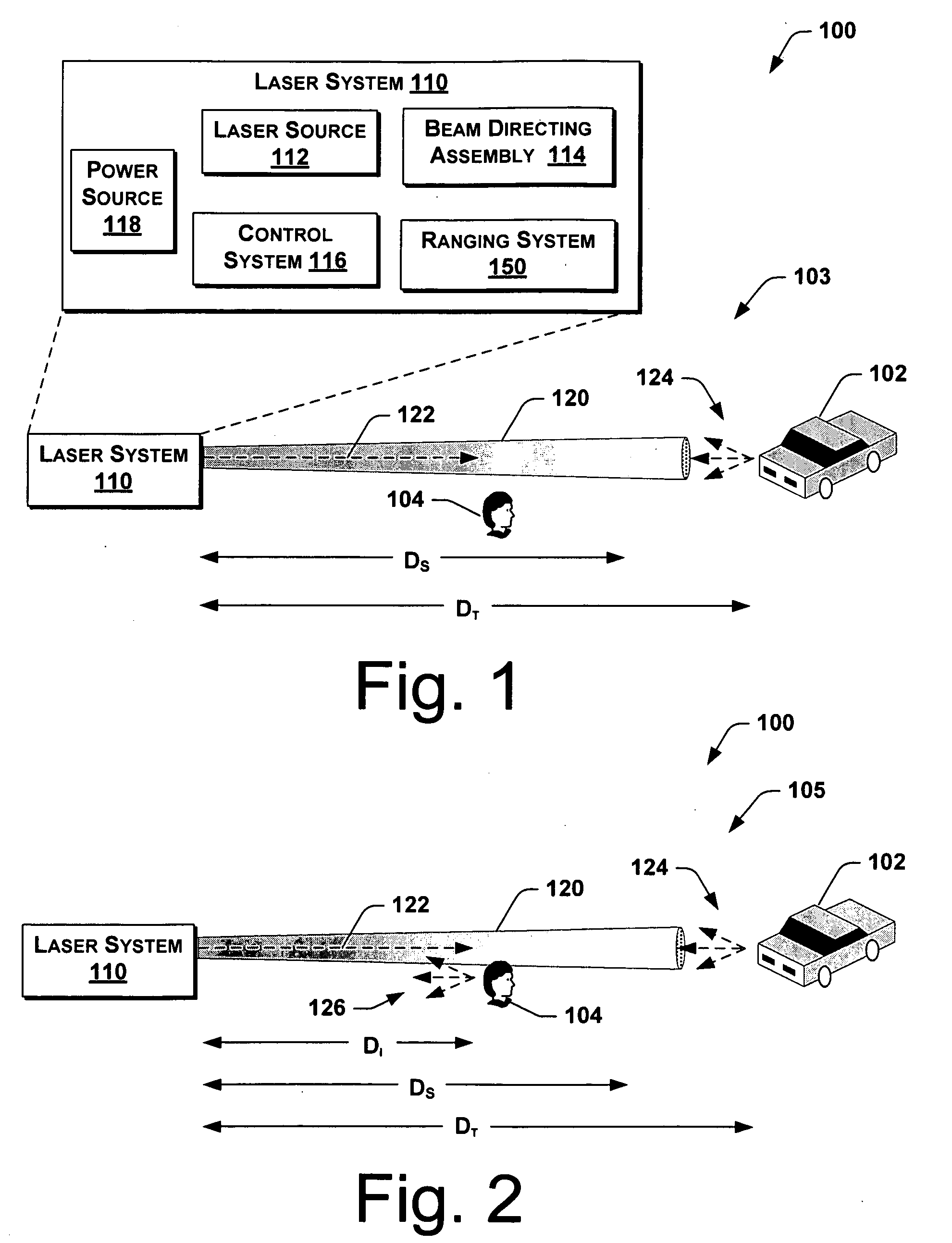

Control Modules for Laser Systems Having Auto-Ranging and Control Capability

ActiveUS20090219962A1Potential riskImprove securityLaser detailsWave based measurement systemsAuto regulationComputer science

Control modules for automatically adjusting a laser output based on a range to an object detected within a field of view are disclosed.

Owner:BRAD E MEYERS

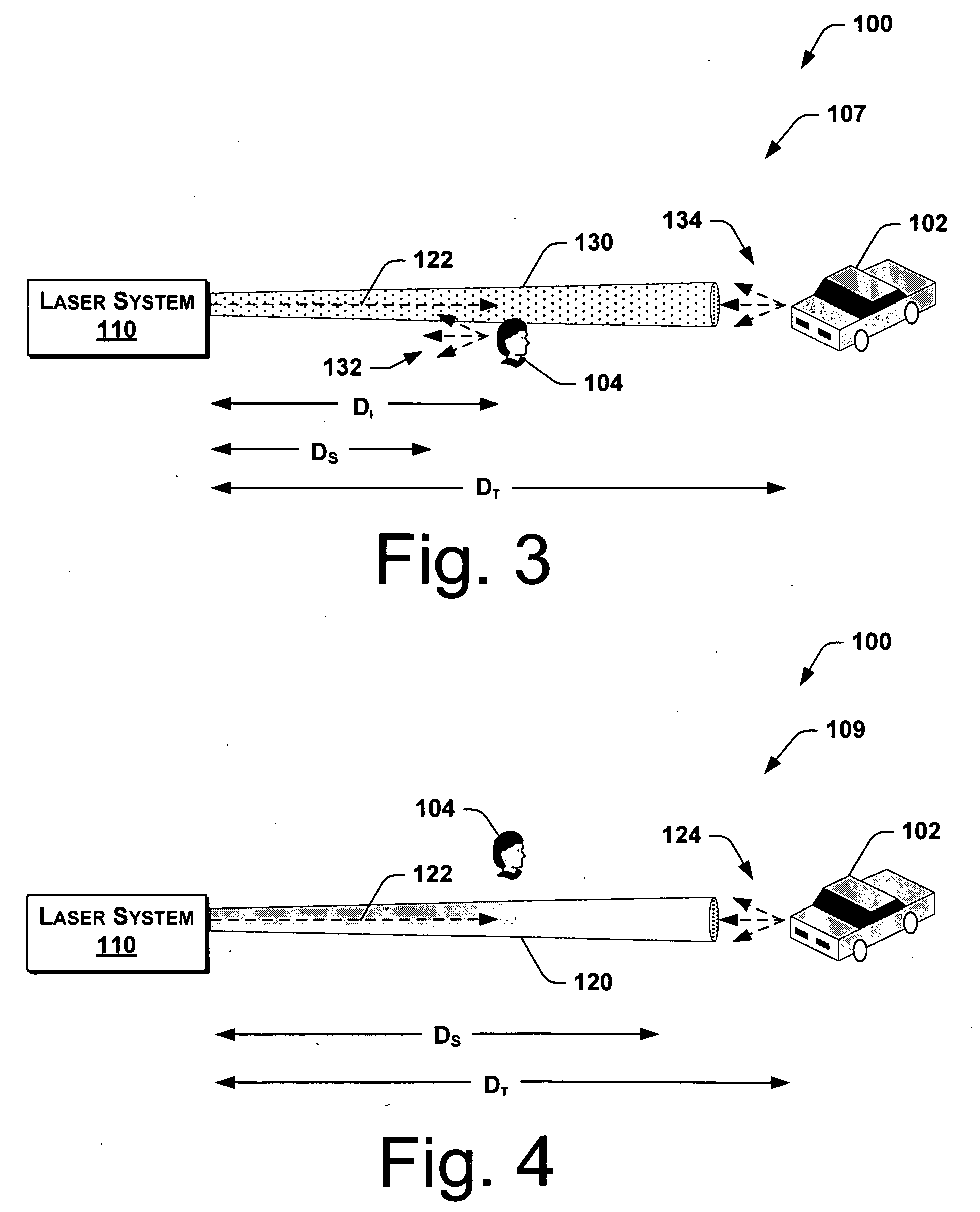

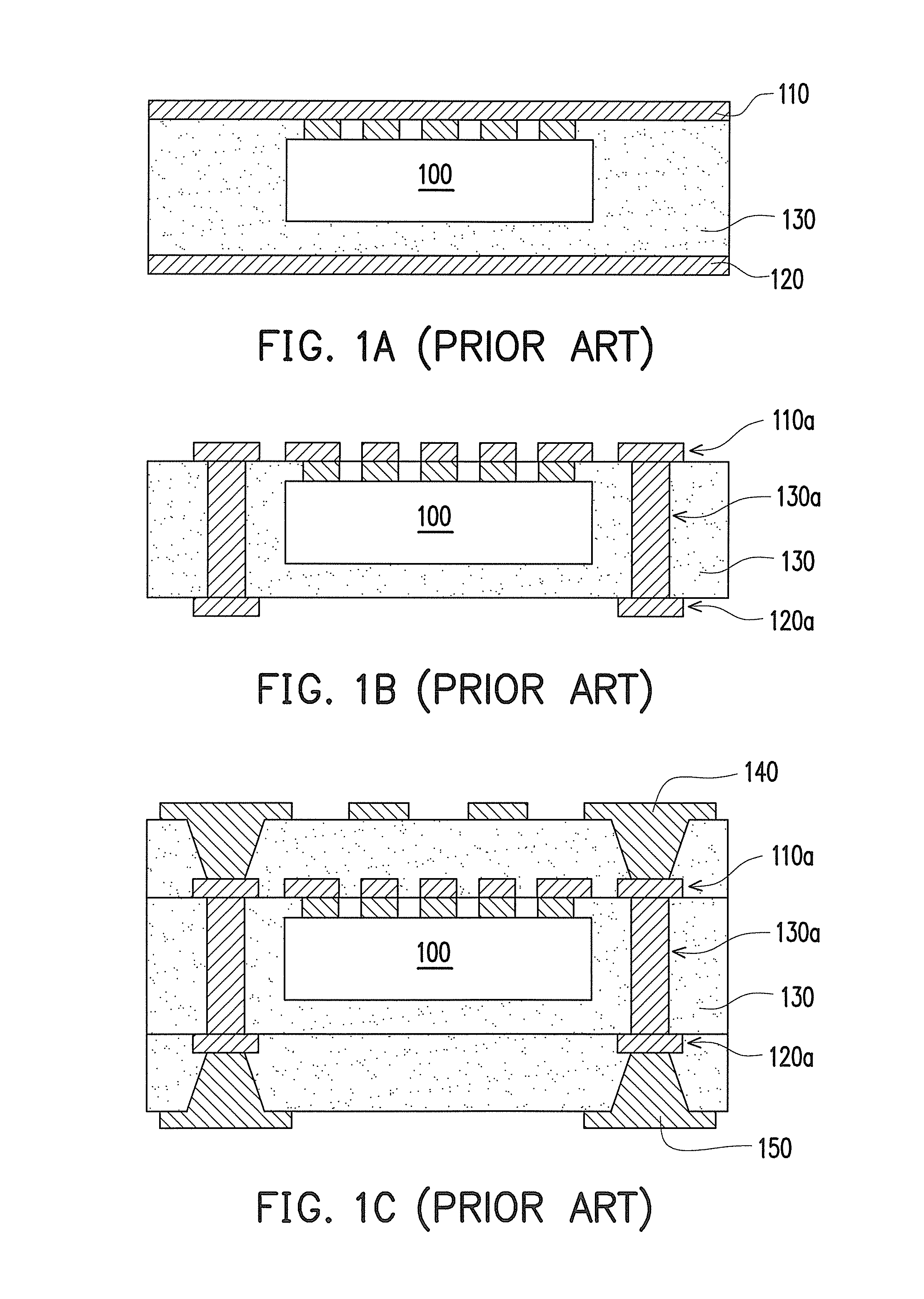

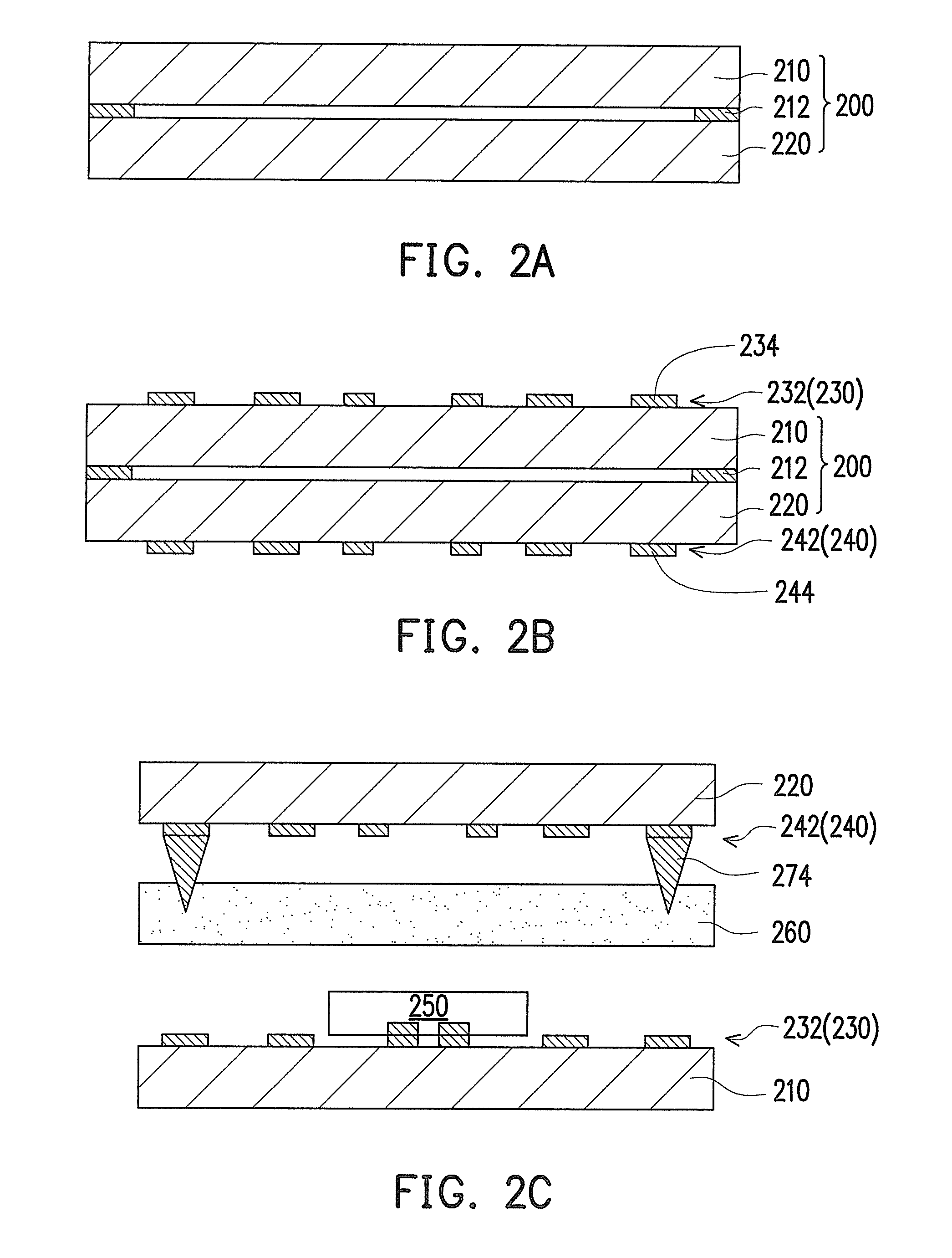

Fabricating method of embedded package structure

ActiveUS20100314352A1Improved reliability and manufacturing yieldImprove reliabilityLamination ancillary operationsSemiconductor/solid-state device detailsElectrical and Electronics engineeringEngineering

A fabricating method of an embedded package structure includes following steps. First, a first circuit structure and a second circuit structure are formed respectively on a first board and a second board which are combined to form an integrated panel. The first board and the second board are then separated. Next, an embedded element is electrically disposed on the first circuit structure. At least one conductive bump is formed on the second circuit structure. Thereafter, a semi-cured film is provided, and a laminating process is performed to laminate the first circuit structure on the first board, the semi-cured film, and the second circuit structure on the second board. The semi-cured film encapsulates the embedded element and the at least one conductive bump pierces through the semi-cured film and electrically connects the first circuit structure.

Owner:UNIMICRON TECH CORP

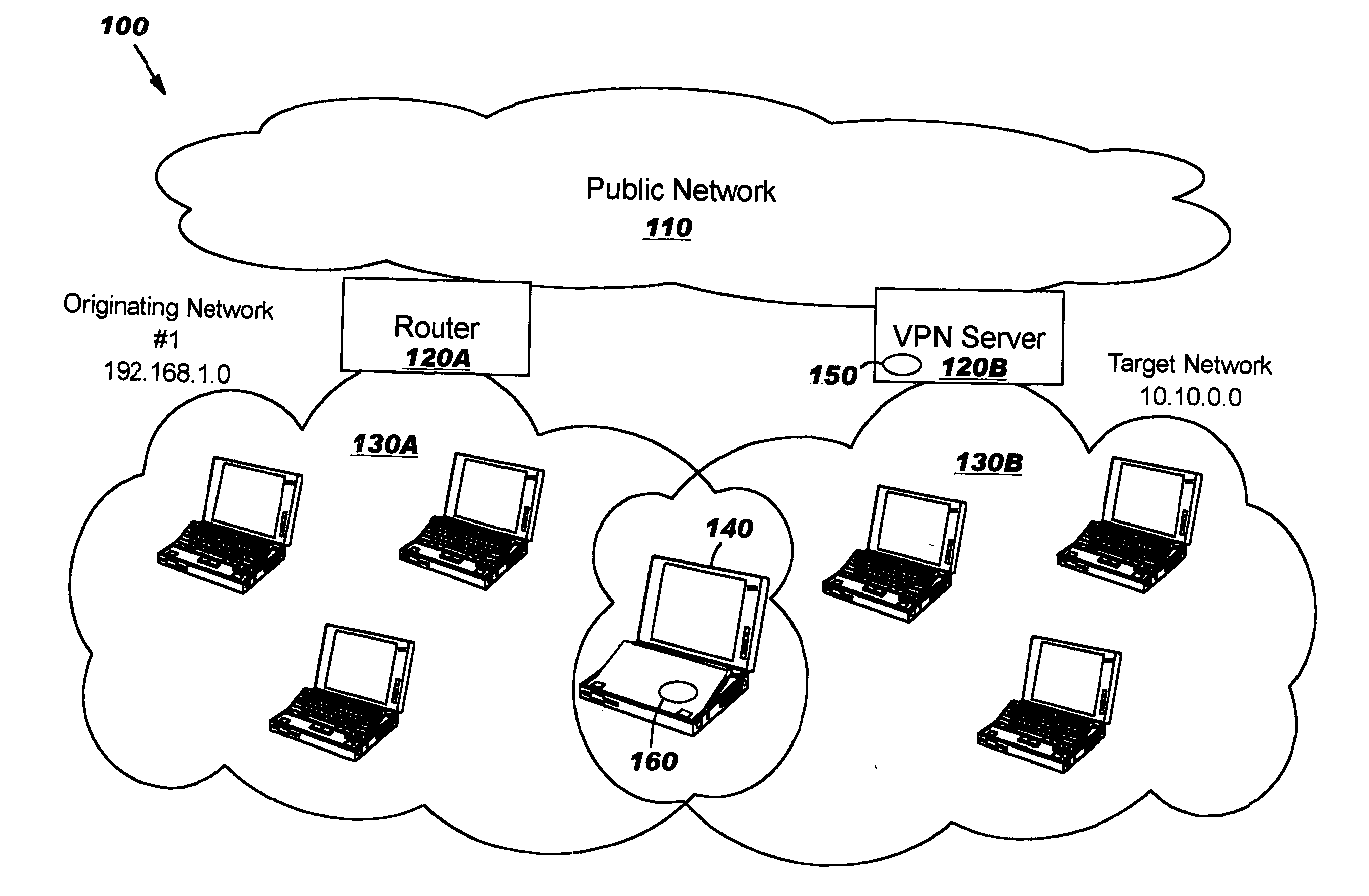

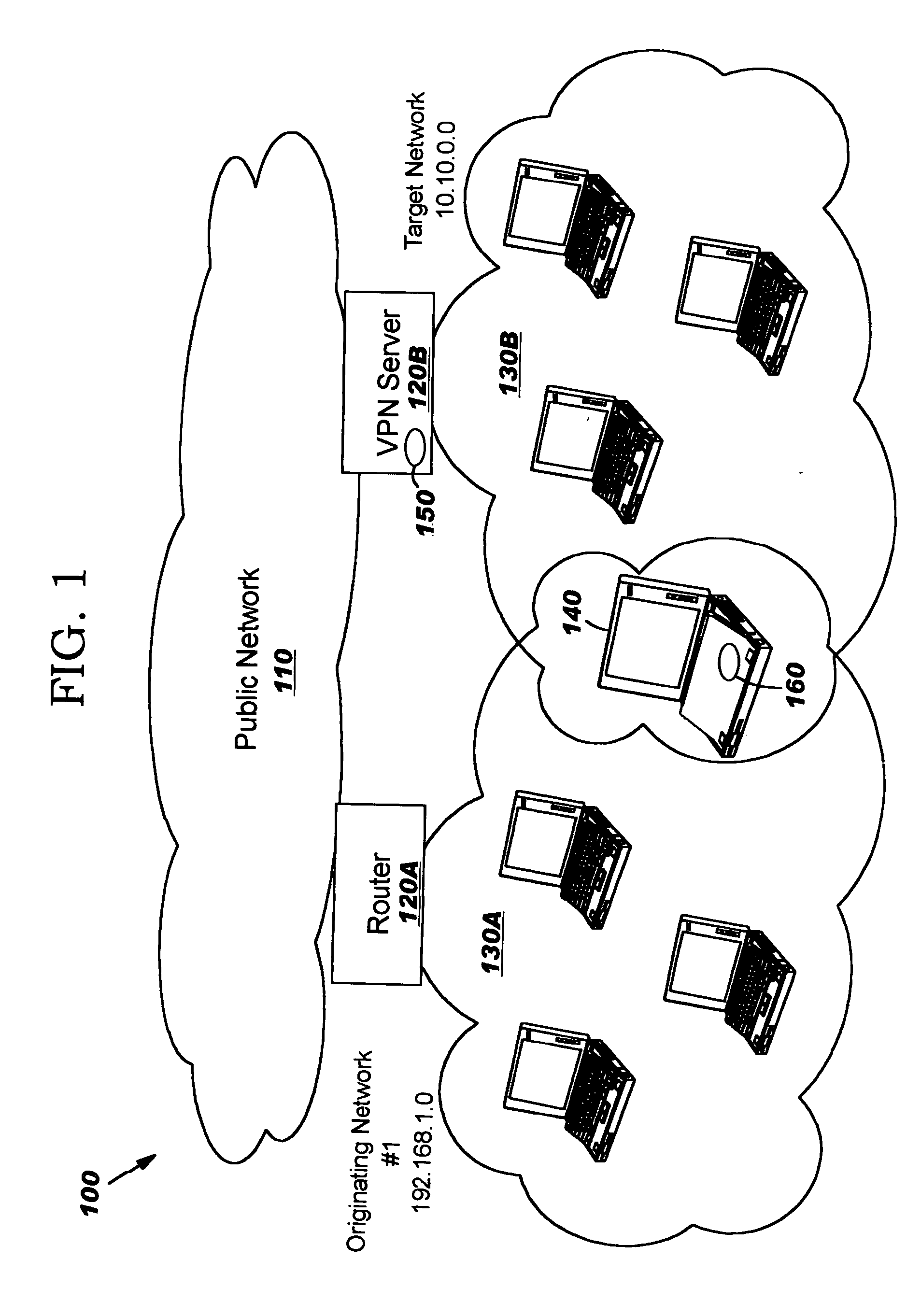

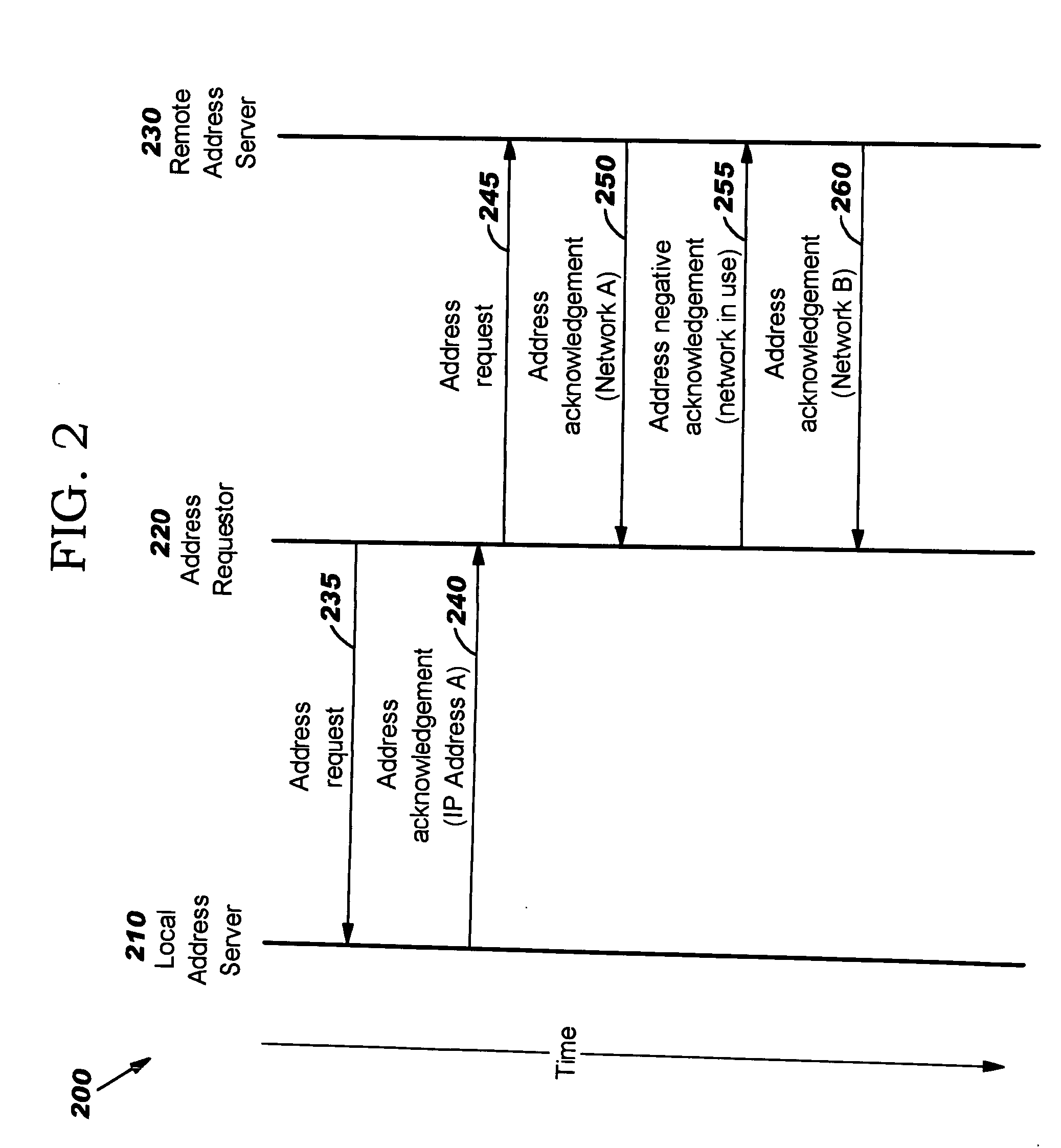

Systems, Methods, and Computer Readable Medium for Avoiding a Network Address Collision

InactiveUS20060085851A1Reduce riskEliminate riskMultiple digital computer combinationsProgram controlNetwork addressingNetwork address

Techniques are provided for avoiding a network address collision when a computer tries to access a target network while being connected to an originating network. To this end, a computer requests a network address for operating in the target network. Upon receiving the requested network address, it is determined whether a conflict exists between the network address for operating in the originating network and the requested network address. If a conflict occurs, a different network address is determined which is different from the requested network address. Upon receipt of the different network address, the computer utilizes the different network address to access the target network, avoiding conflict with the network address for operating in the originating network.

Owner:IBM CORP

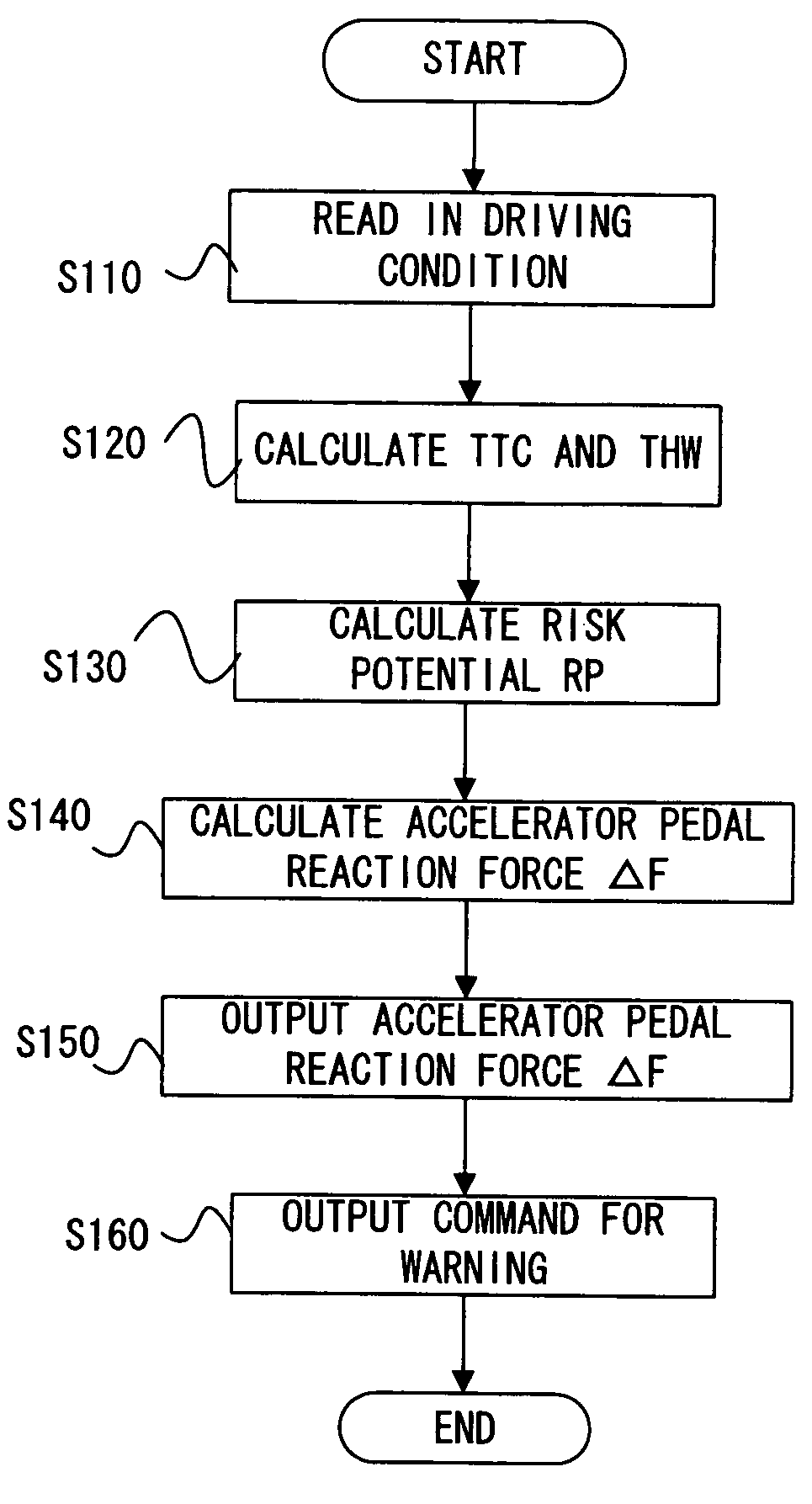

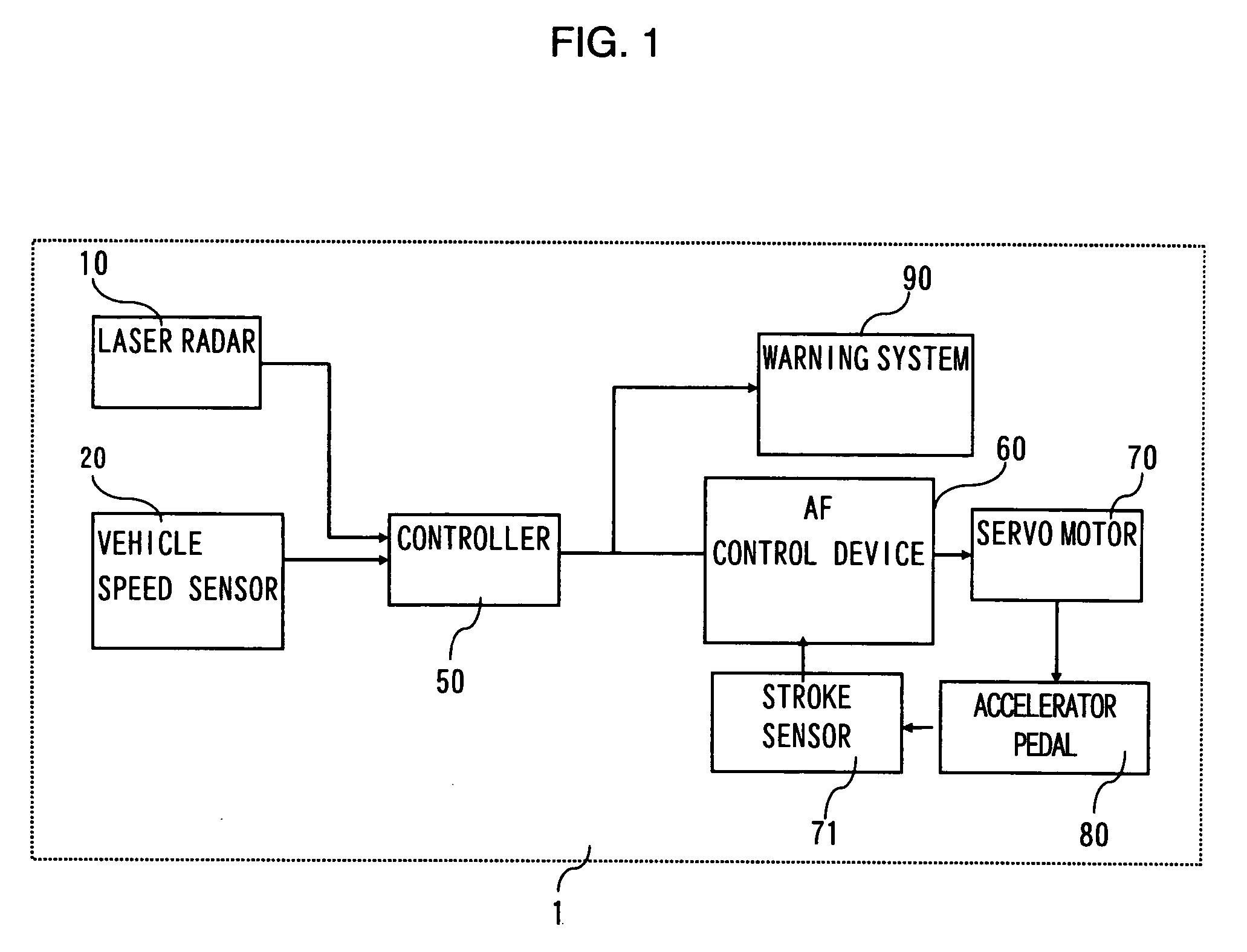

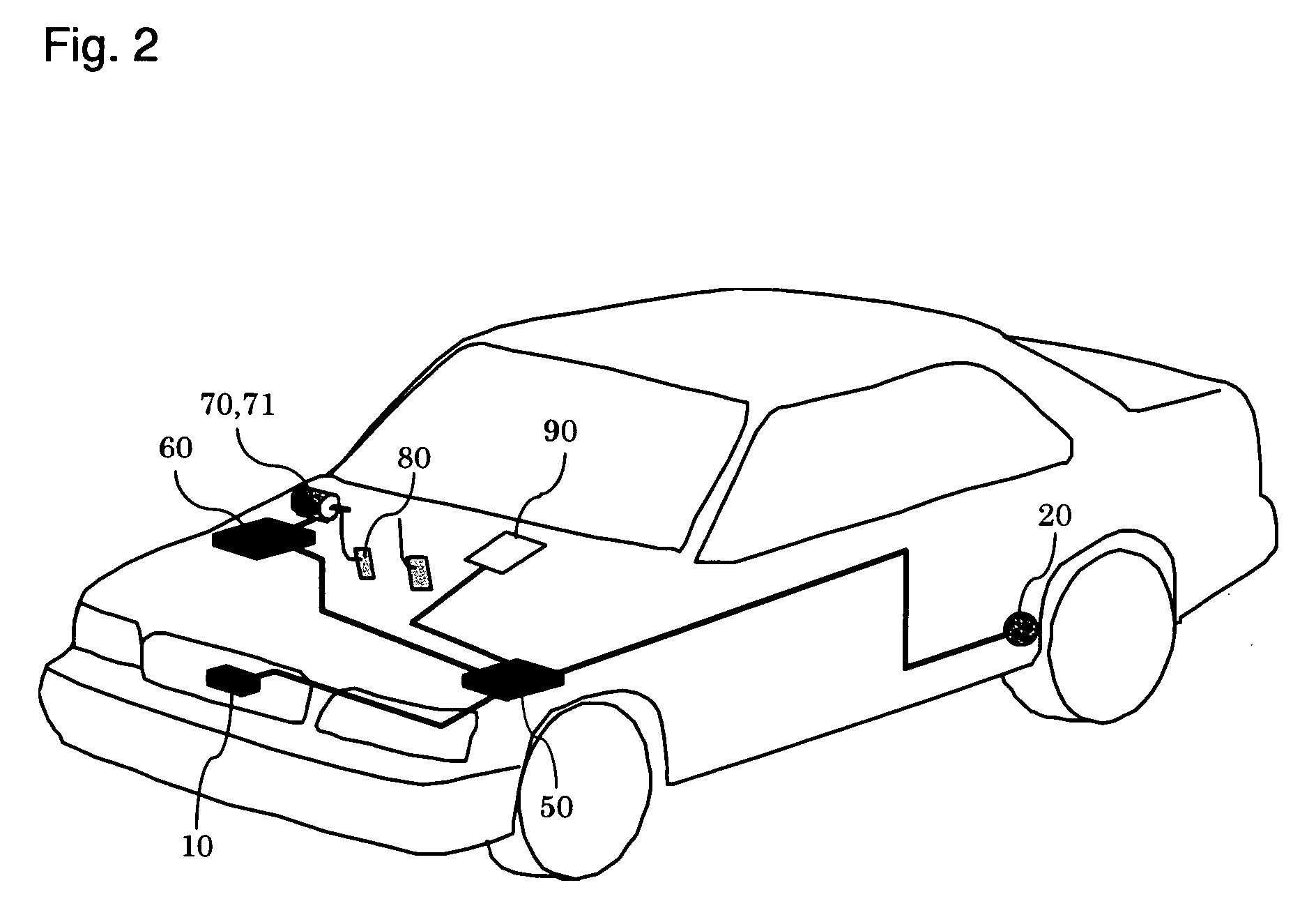

Driving assist system for vehicle

InactiveUS7200481B2Potential riskVehicle fittingsDigital data processing detailsSubject matterVehicle driving

A vehicle driving assist system of the present invention detects a vehicle condition and a traveling environment of a subject vehicle; and calculates an extent of influence on the subject vehicle due to future changes in surrounding environment. The vehicle driving assist system then calculates the risk potential around the subject vehicle based on the extent of influence. Operation reaction force of an accelerator pedal is controlled according to the risk potential thus calculated.

Owner:NISSAN MOTOR CO LTD

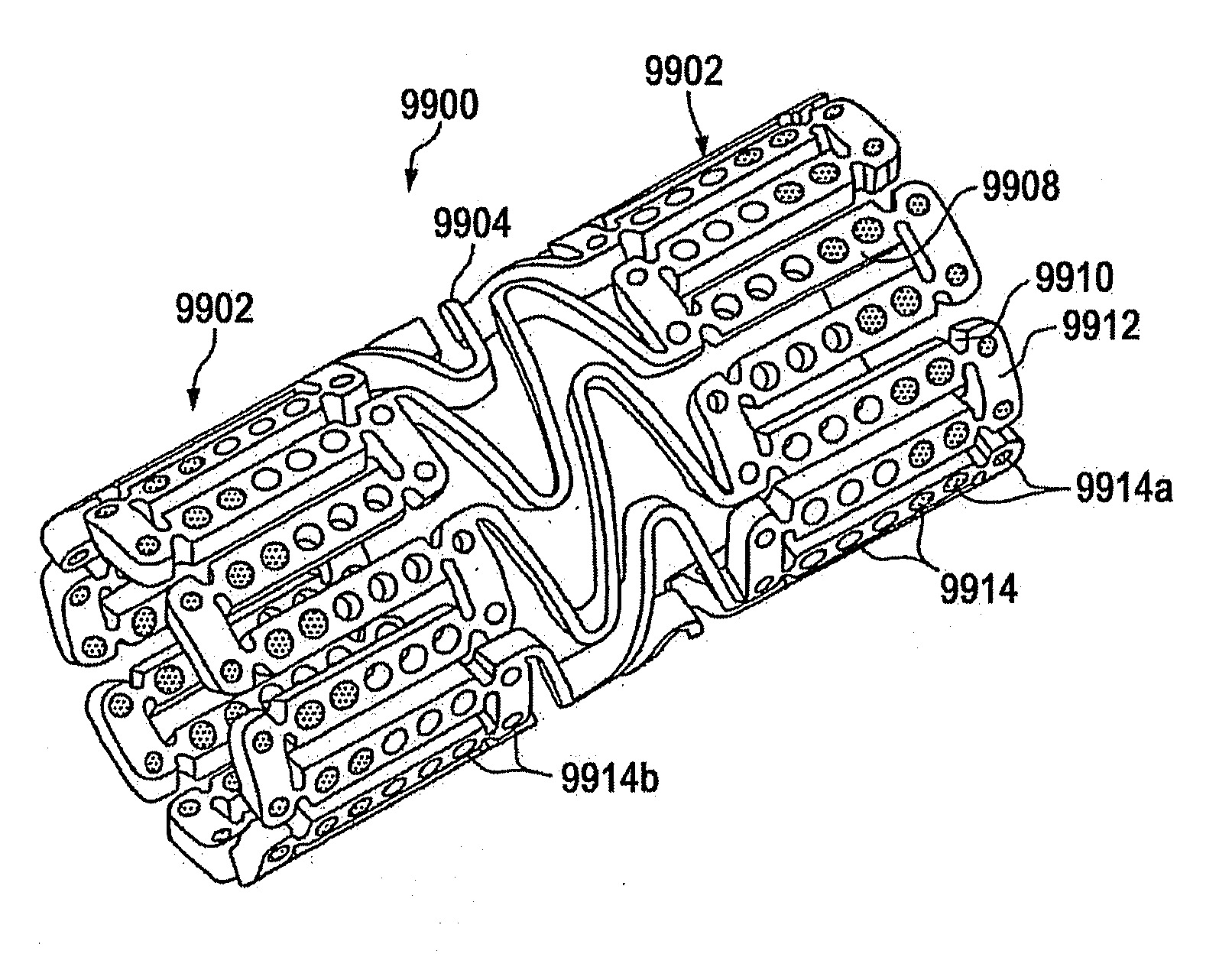

Bare metal stent with drug eluting reservoirs

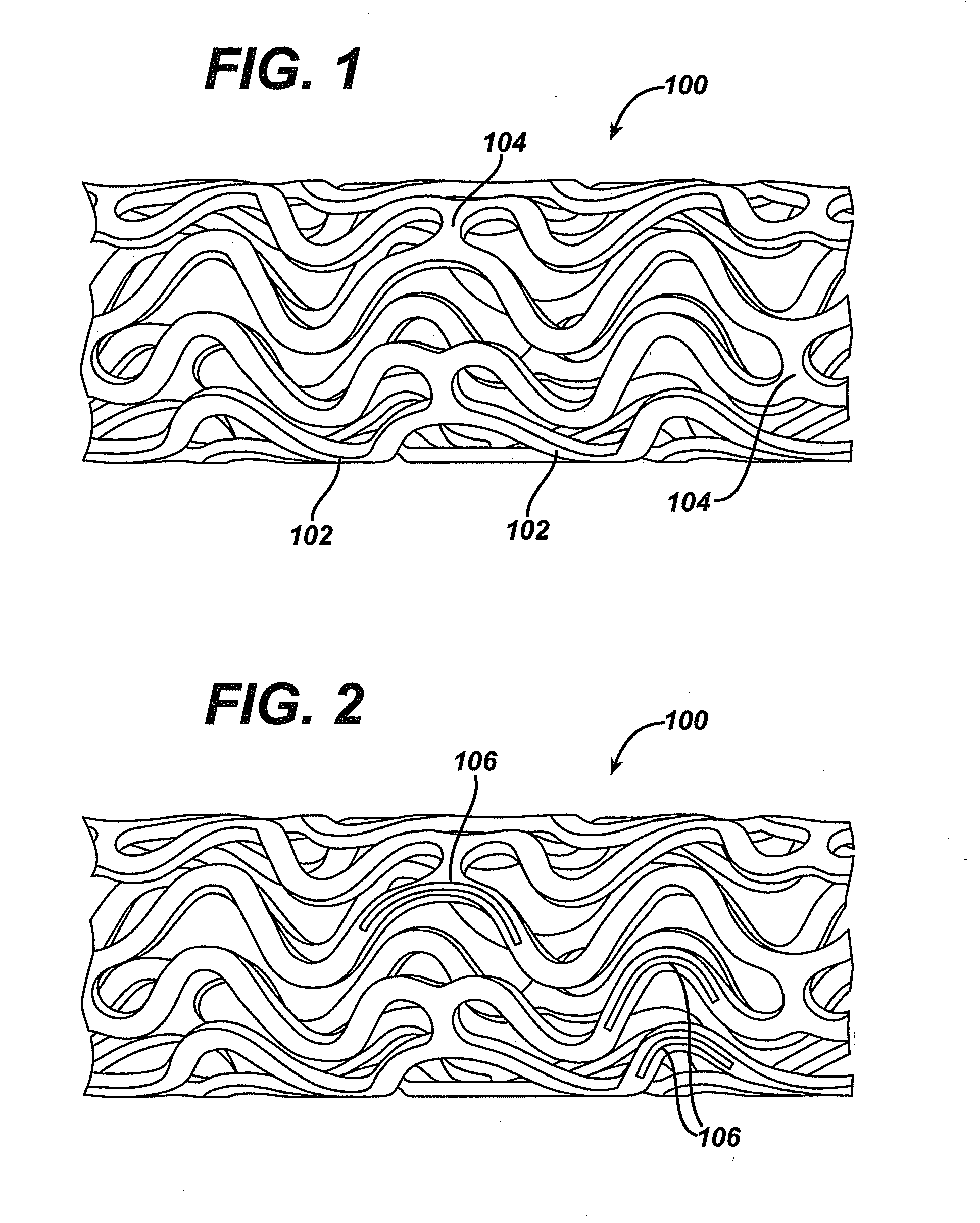

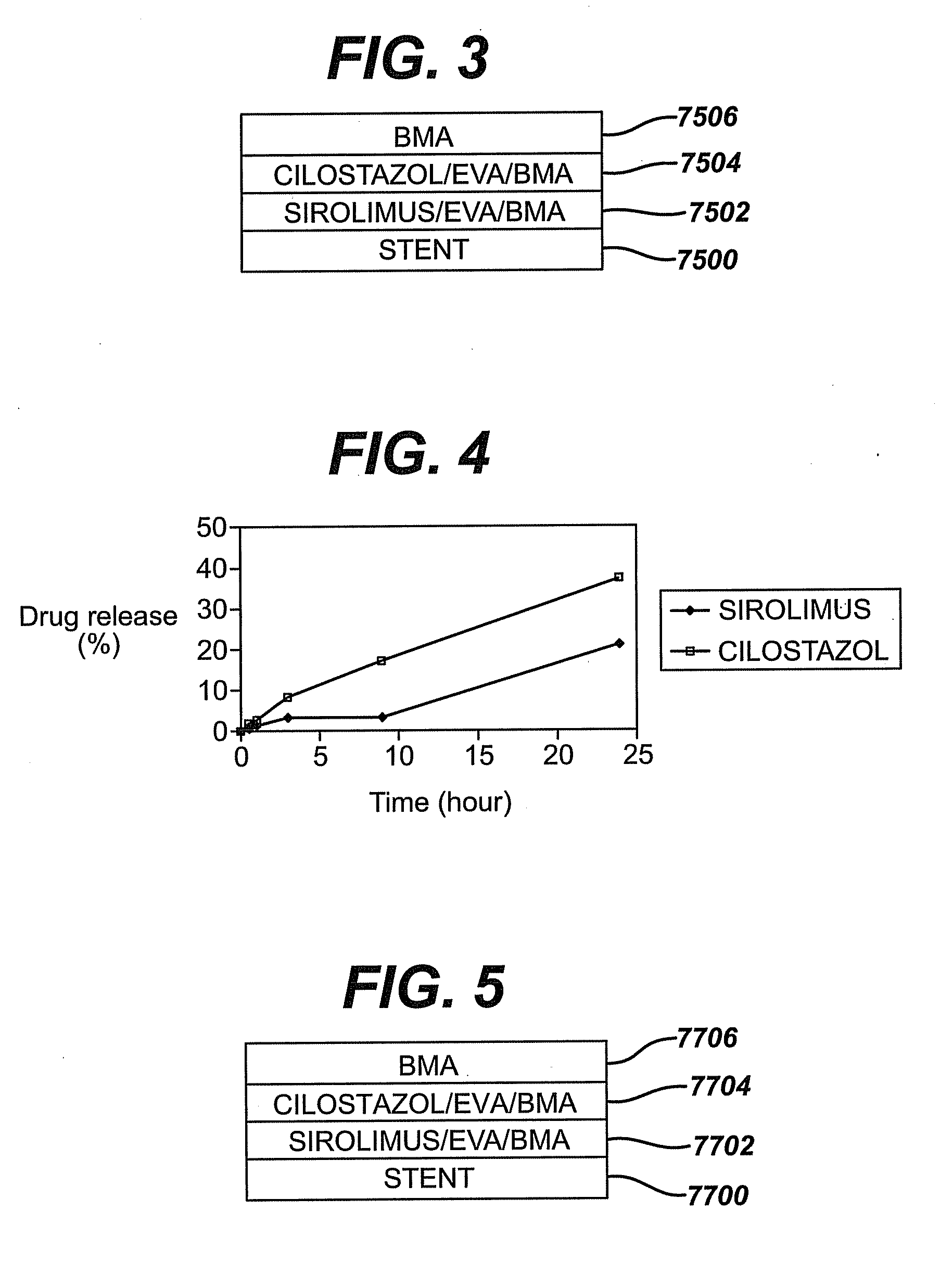

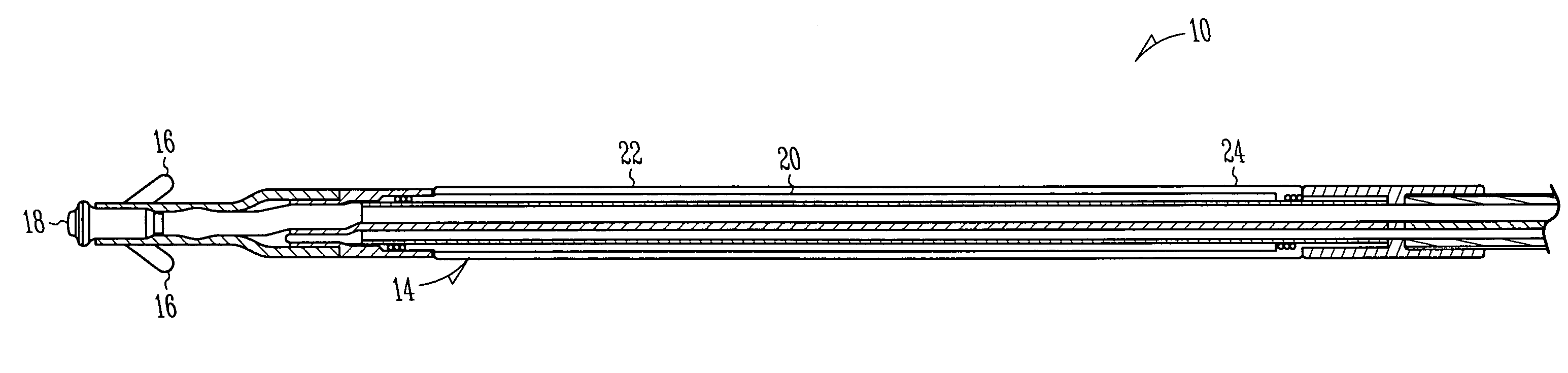

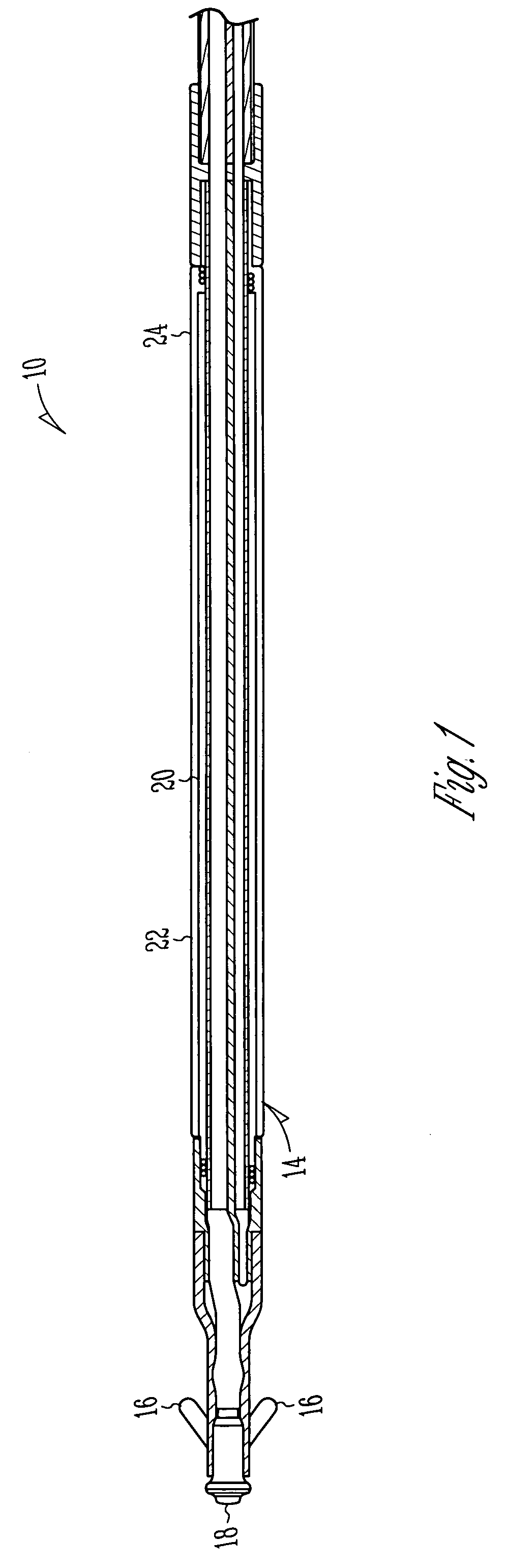

Implantable medical devices may be utilized to locally delivery one or more drugs or therapeutic agents to treat a wide variety of conditions, including the treatment of the biological organism's reaction to the introduction of the implantable medical device. These therapeutic agents may be released under controlled and directional conditions from a stent so that the one or more therapeutic agents reach the correct target area, for example, the surrounding tissue.

Owner:CORDIS CORP

Conductive polymer sheath on defibrillator shocking coils

InactiveUS7756589B2Minimizing and eliminating direct contactPotential riskElectrotherapyPorosityDistal portion

An implantable lead includes a distal portion carrying a tissue stimulating electrode, at least a portion of its outer surface being adapted to stimulate cardiac tissue, wherein the electrode is covered by a pliable, electrically conductive sheath. The sheath is made of an electrically conductive material that does not rely on porosity for electrical charge transfer. The sheath is constructed and arranged to minimize or eliminate tissue ingrowth while passing sufficient electrical energy to stimulate the tissue.

Owner:CARDIAC PACEMAKERS INC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com