Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

30 results about "Financial evaluation" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Financial evaluation is defined as the process of evaluating various projects, budgets, businesses and further finance-related subsidiaries to agree on their viability for investment. Financial evaluation or popularly known as financial analysis is used to examine whether a unit is steady, liquid, solvent, or profitably adequate to be invested in.

Financial evaluation process

Quantitatively improving a financial evaluation is disclosed. A plurality of factor scores based on a plurality of factors is determined. A total score is calculated based on the plurality of factor scores. A plurality of actions is identified that will influence at least a portion of the plurality of factor scores. The actions are ranked based on their total impact on the plurality of factor scores. A most important action of the plurality of actions to improve the total score is determined.

Owner:UNITED CAPITAL FINANCIAL ADVISORS LLC

Blockchain-based supply chain financial anti-counterfeiting traceability method

InactiveCN108229981ASolve difficultySolve possible shortcomings such as fraud and fraudFinanceDigital data protectionMultiple encryptionThird party

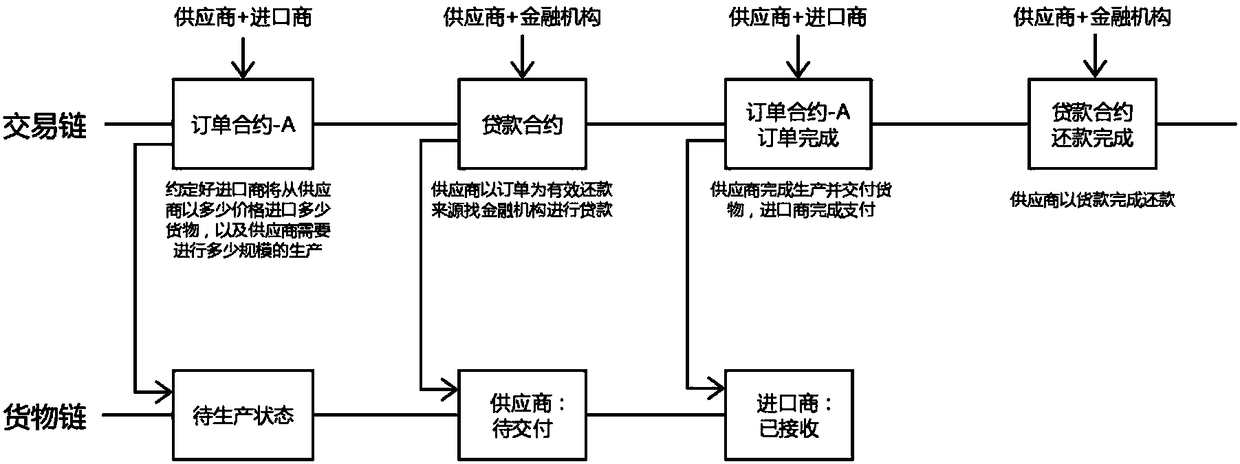

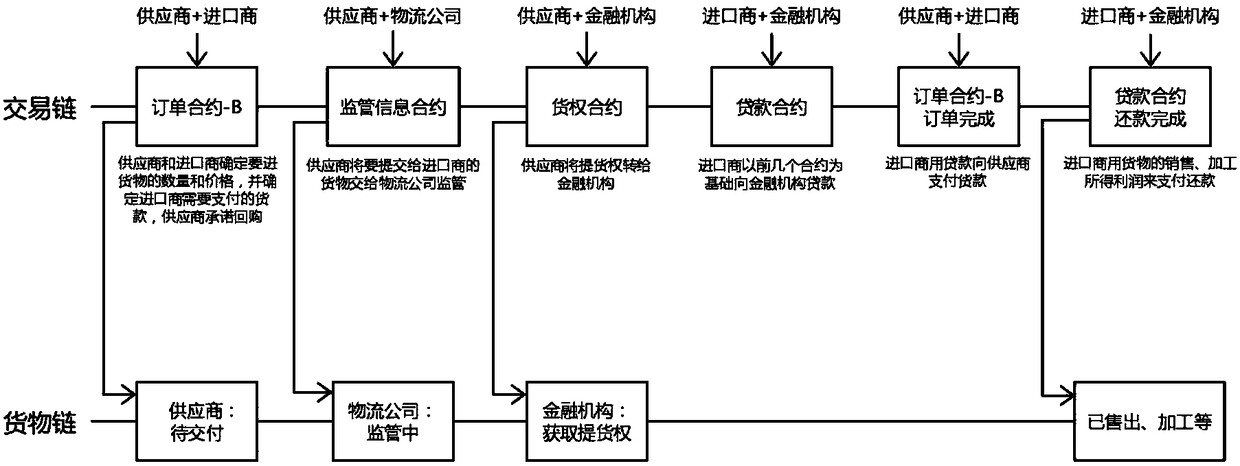

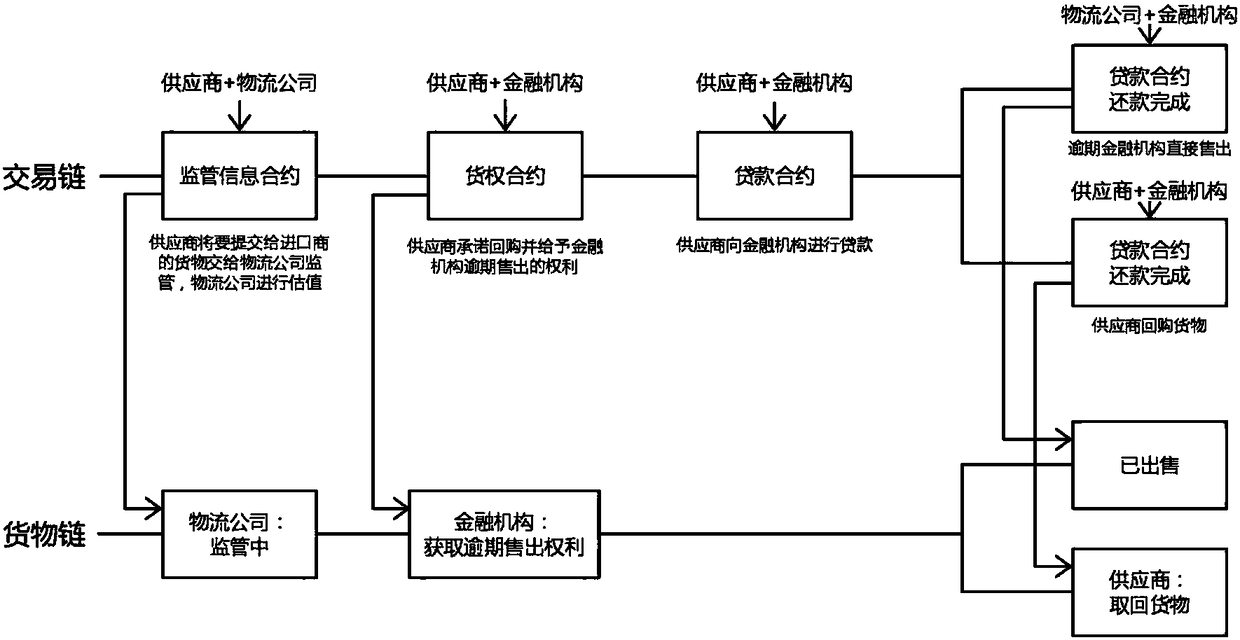

The invention discloses a blockchain-based supply chain financial anti-counterfeiting traceability method. The method utilizes the advantages of blockchain decentralization, no need for a third-partytrust system, multiple encryption algorithms and the like, the method is achieved through smart contracts in supply chain finance, and the defect of a traditional anti-counterfeiting traceability method can be better solved. By using the characteristic that a blockchain cannot be distorted, all of the content of the contracts including the state of goods can be clearly found, and the defects thatthe traditional anti-counterfeiting traceability method needs to be transferred by a paper certificate, a third-party guarantee or certification institution is needed, the fundraising difficulty of small and medium size enterprises is large, cheating and fraud might exist and the like are solved. Contractual agreement, logistics supervision and financial evaluation between buyers and sellers are achieved through the smart contracts, paper contracts are not needed because all of the contracts are finished in a system, complicated procedures are reduced, and the process is accelerated.

Owner:HANGZHOU YUNXIANG NETWORK TECH

Distribution network planning scheme evaluation data processing system

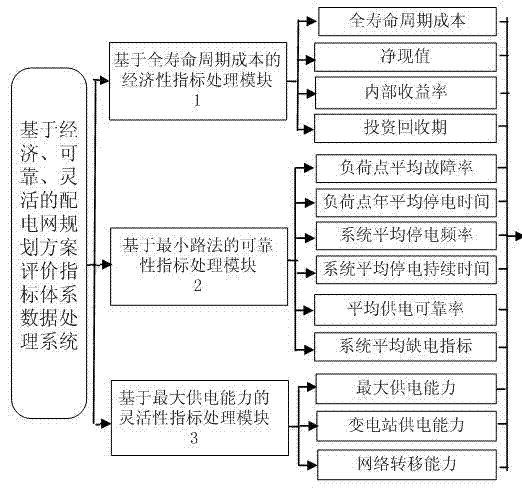

The invention discloses a distribution network planning scheme evaluation data processing system which comprises an economic index processing module based on whole life cycle cost, a reliability index processing module based on a minimal path method, and a flexibility index processing module based on maximum power supply capability. The economic index processing module based on the whole life cycle cost is used for taking the investment cost, operation and maintenance cost, life period and the like as input data, calculating and processing the data and outputting the whole life cycle cost and traditional financial evaluation indexes; the reliability index processing module is used for taking the planning scheme structure, equipment parameters and the like as input data, outputting the system average interruption frequency and other indexes of load nodes and the equivalent mean interruption duration on the system side and the other indexes; and the flexibility index processing module based on the maximum power supply capability is used for outputting the maximum power supply capability, the network transfer capability and the other indexes. Finally, comprehensive evaluation of multiple indexes is realized by adopting a fuzzy mathematics comprehensive evaluation module. Compared with the prior art, the distribution network planning scheme evaluation data processing system disclosed by the invention has the advantages of comprehensiveness and practicality.

Owner:STATE GRID CORP OF CHINA +3

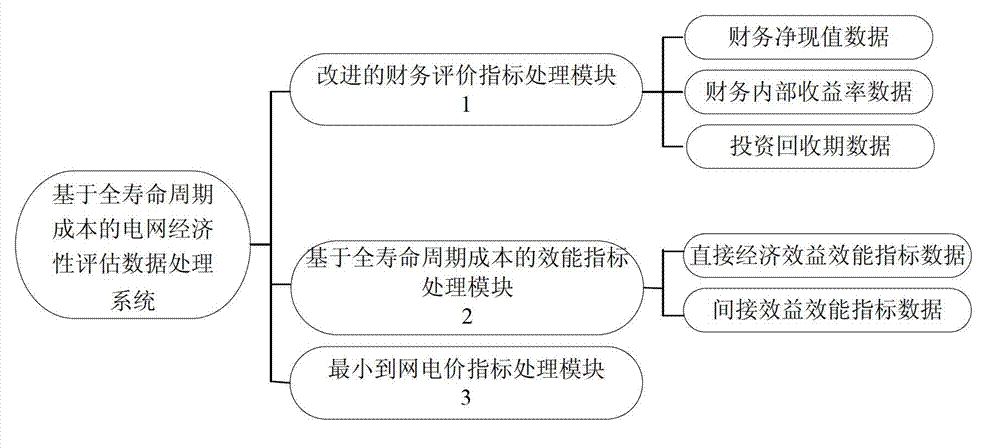

Power grid economy evaluation data processing system based on life cycle cost

InactiveCN102855402AOvercome limitationsAccurate economic evaluation resultsSpecial data processing applicationsData processing systemEconomic benefits

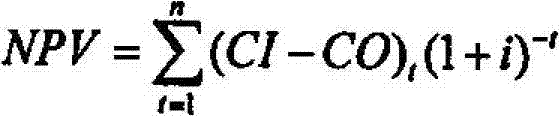

The invention relates to a power grid economy evaluation data processing system based on life cycle cost. The system comprises an improved financial evaluation index processing module, an effect index processing module based on the life cycle cost and a lowest on-grid price index processing module. After calculating and processing input data including life cycle cost data, newly increased cash inflow data and newly increased cash outflow data within a research period, the improved financial evaluation index processing module outputs financial net present value data, financial internal-rate-of-return data and investment payback period data. After calculating and processing the input data, namely the life cycle cost data, within the research period, the effect index processing module based on the life cycle cost outputs direct economic benefit effect index data and indirect economic benefit effect index data. The lowest on-grid price index processing module is used for calculating the lowest on-grid price data. Compared with the prior art, the power grid economy evaluation data processing system based on the life cycle cost has the advantages of objectivity, comprehensiveness, accuracy in evaluation and the like.

Owner:SHANGHAI JIAO TONG UNIV +1

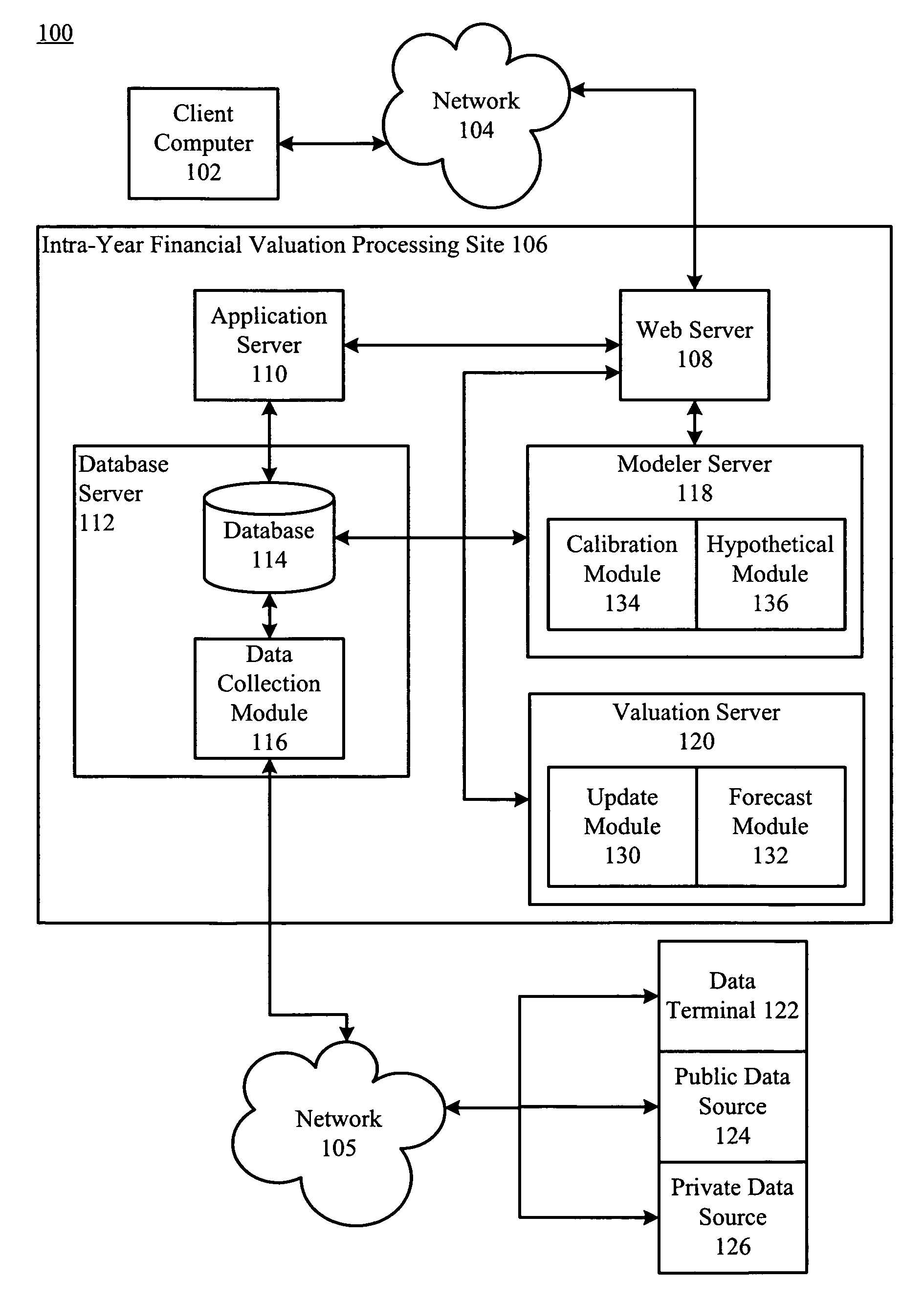

Estimating financial valuation of benefit plans

Intra-year benefit plan financial valuation for a client's post-retirement benefit plan comprises collecting intra-year capital market data during a time period between a first actuarial valuation and a second actuarial valuation, converting the intra-year capital market data to intra-year client-specific data based on client assumptions, and calculating an updated financial valuation for the benefit plan based on the intra-year client-specific data, benefit plan data, and the client assumptions. The updated financial valuation can comprise an updated forecast financial valuation based on the intra-year client-specific data and future client assumptions. The updated financial valuation can be calibrated based on actual client-specific data reflecting experience between the time of the first actuarial valuation and the updated financial valuation. The intra-year client-specific data can provide a basis for a hypothetical forecast analysis based on hypothetical data provided by the client.

Owner:TOWERS PERRIN CAPITAL

Data propagation method and device based on graph data and back propagation algorithm and electronic equipment

PendingCN111199418AIncrease profitSend accuratelyFinanceNeural learning methodsAlgorithmBack propagation algorithm

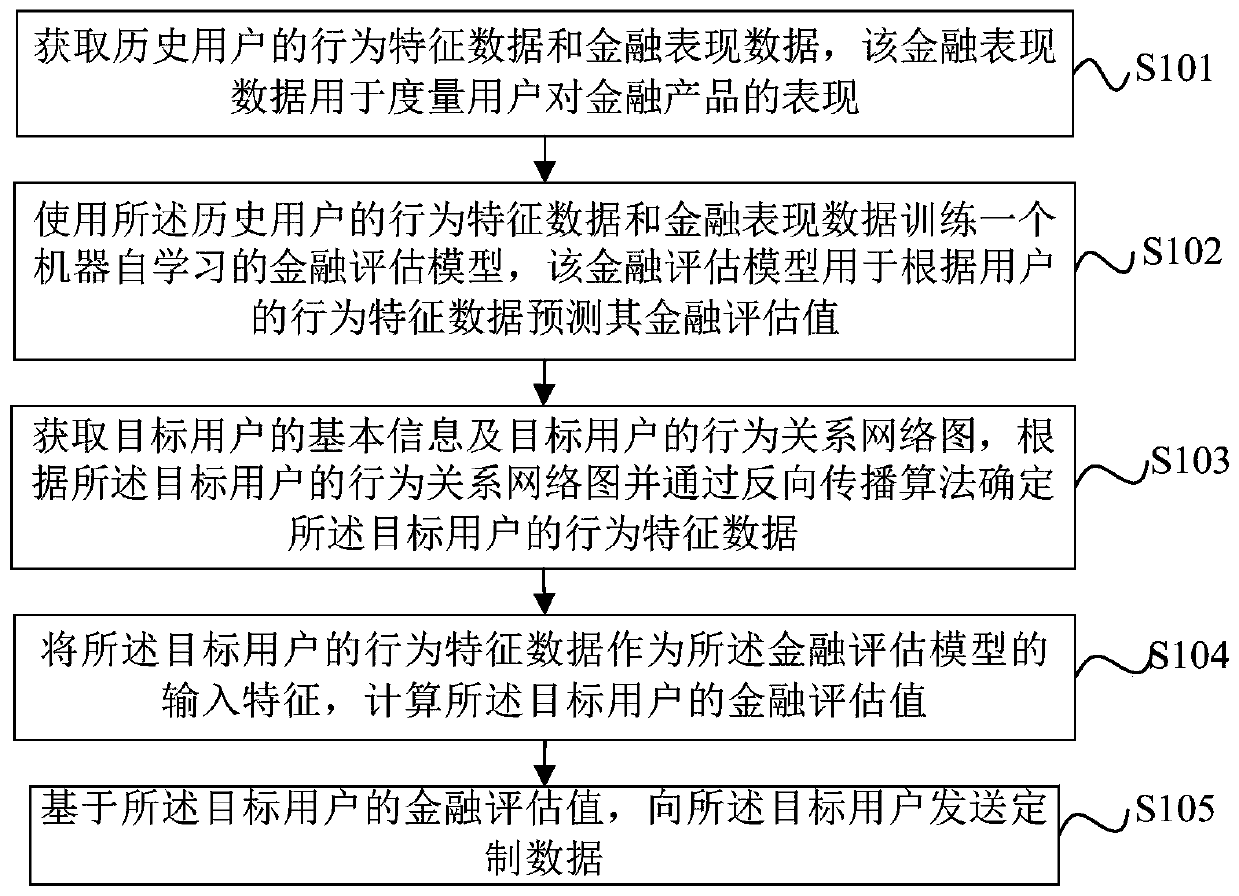

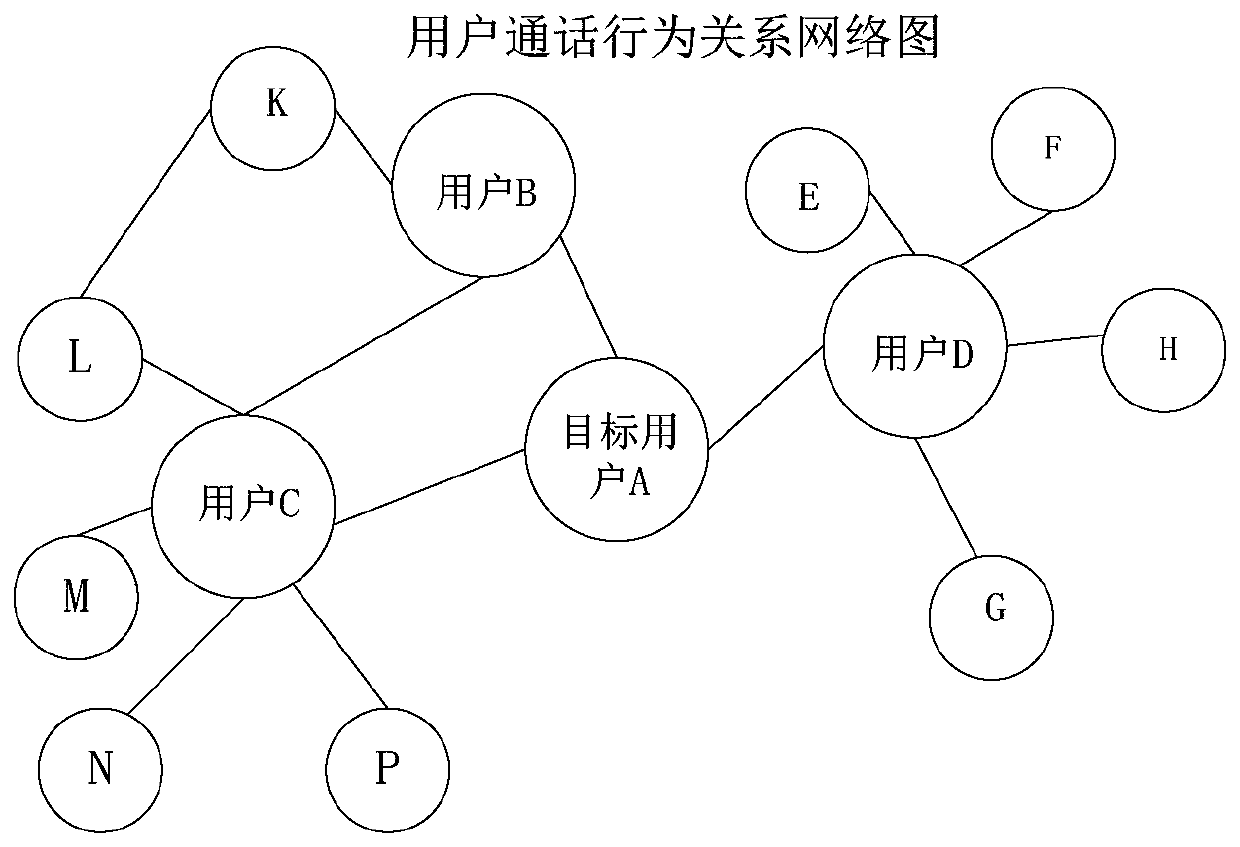

The invention provides a data propagation method and device based on graph data and a back propagation algorithm and electronic equipment. The method comprises the steps of obtaining behavior characteristic data and financial performance data of a historical user, wherein the financial performance data is used for measuring performance of the user on a financial product; training a financial evaluation model by using the behavior characteristic data and the financial performance data of the historical users; obtaining basic information of the target user and a behavior relationship network diagram of the target user, and determining behavior characteristic data of the target user according to the behavior relationship network diagram of the target user through a back propagation algorithm;taking the behavior characteristic data of the target user as input characteristics of a financial evaluation model, and calculating a financial evaluation value of the target user; and sending customized data to the target user based on the financial evaluation value of the target user. According to the invention, corresponding customized data can be sent to various users more accurately, the efficiency is improved, and the marketing cost is reduced.

Owner:北京淇瑀信息科技有限公司

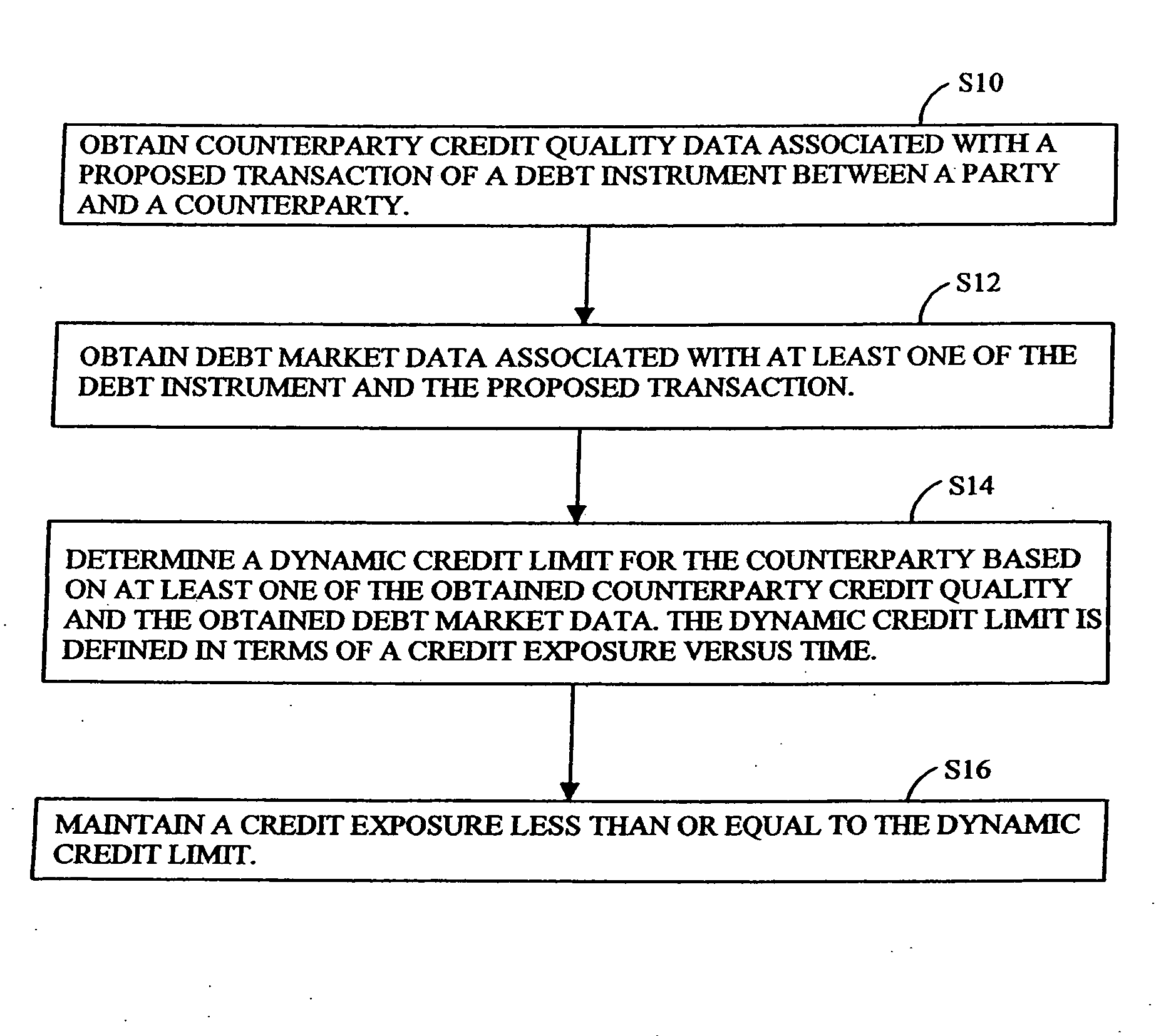

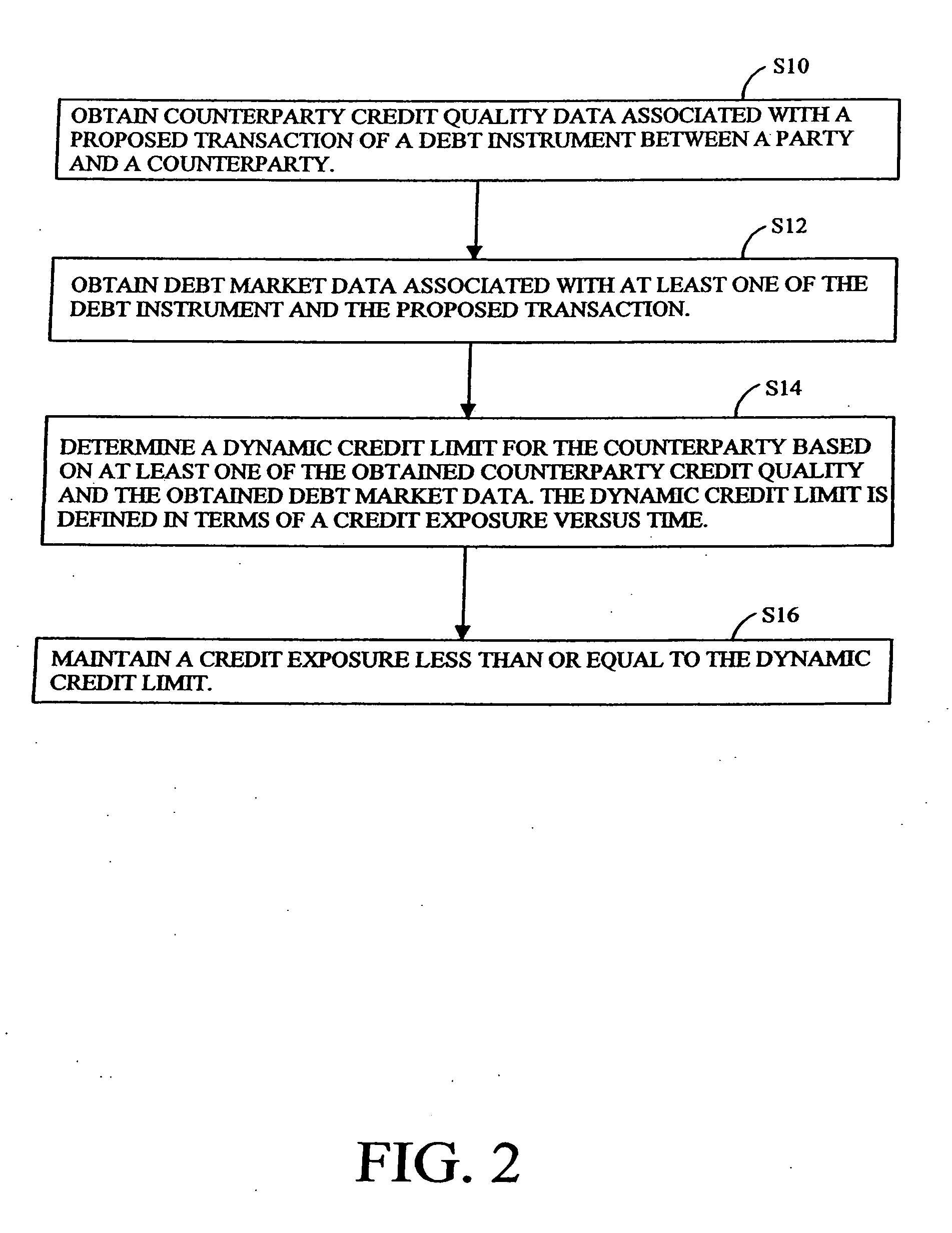

Dynamic credit management

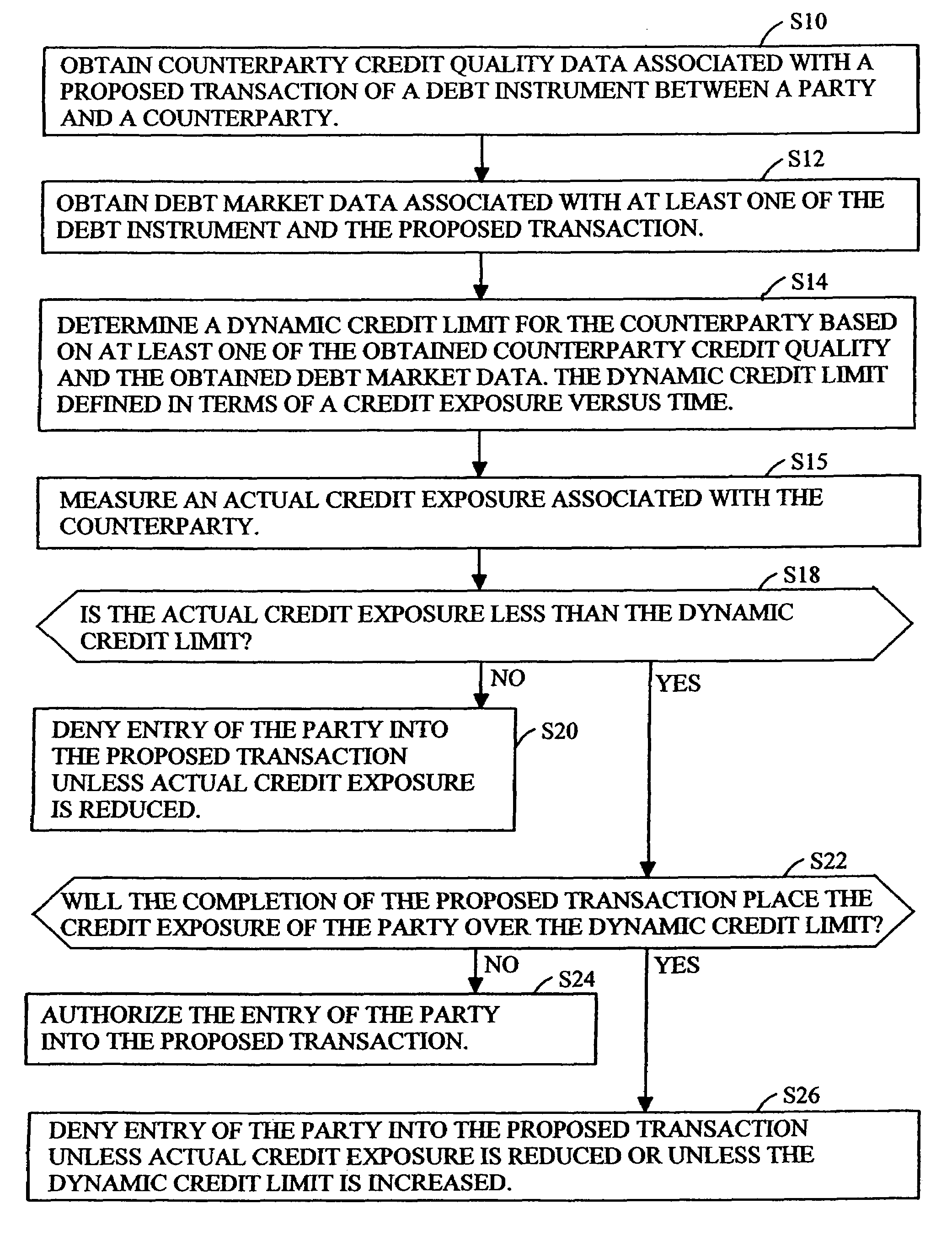

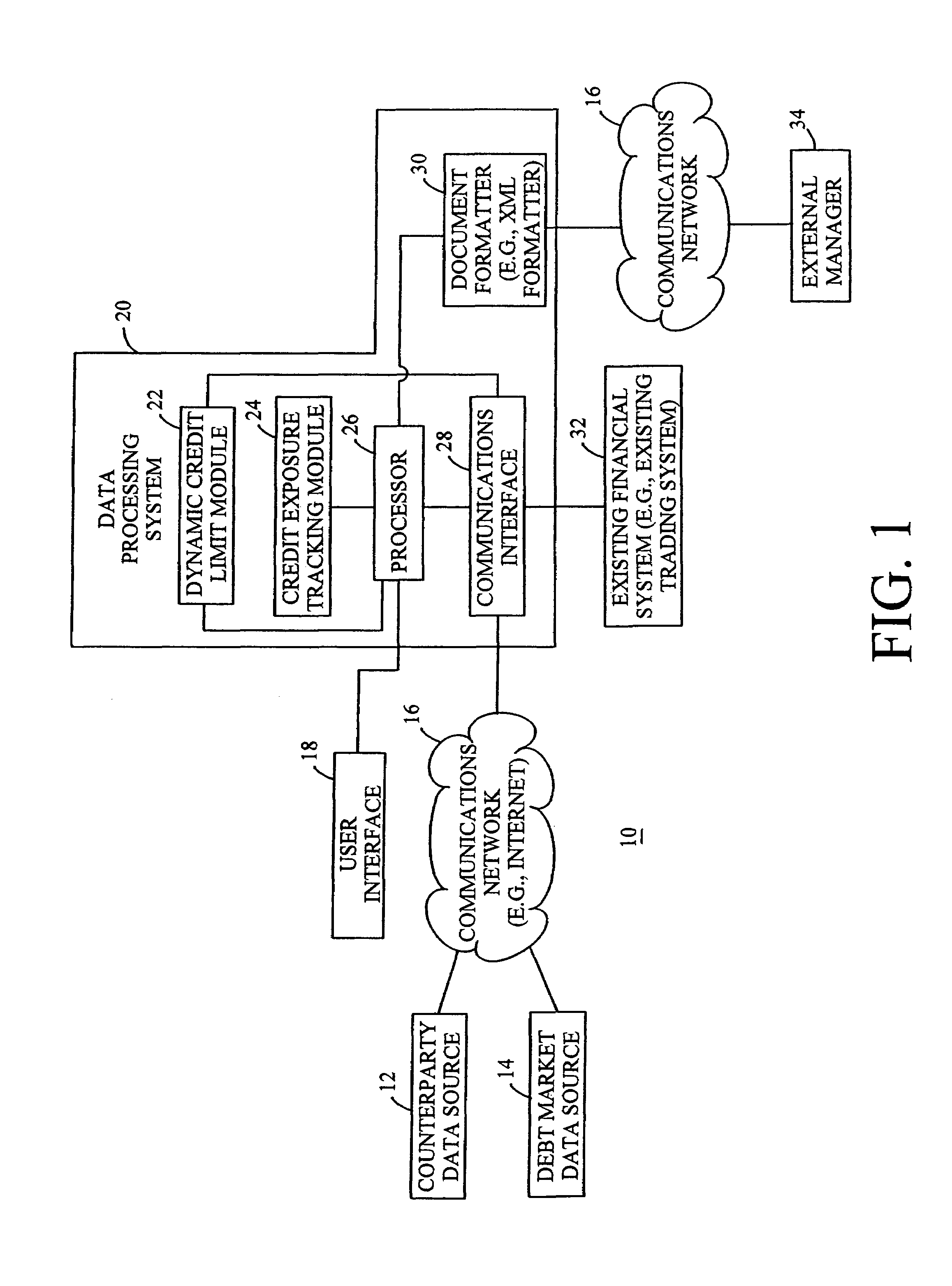

A method for providing a financial evaluation of at least one financial instrument or of an issuer supports the provision of a dynamic credit limit. A dynamic credit limit may be associated with a counterparty or a debt security of the counterparty, for example. The method includes obtaining counterparty credit quality data associated with a transaction of the financial instrument between a party and a counterparty. Debt market data is obtained where the debt market data is associated with or relevant to the transaction. A dynamic credit limit is determined for the counterparty or a financial instrument of the counterparty based on at least one of the inputted counterparty credit quality and the obtained debt market data. The dynamic credit limit may be defined in terms of a credit exposure versus time.

Owner:ACCENTURE GLOBAL SERVICES LTD

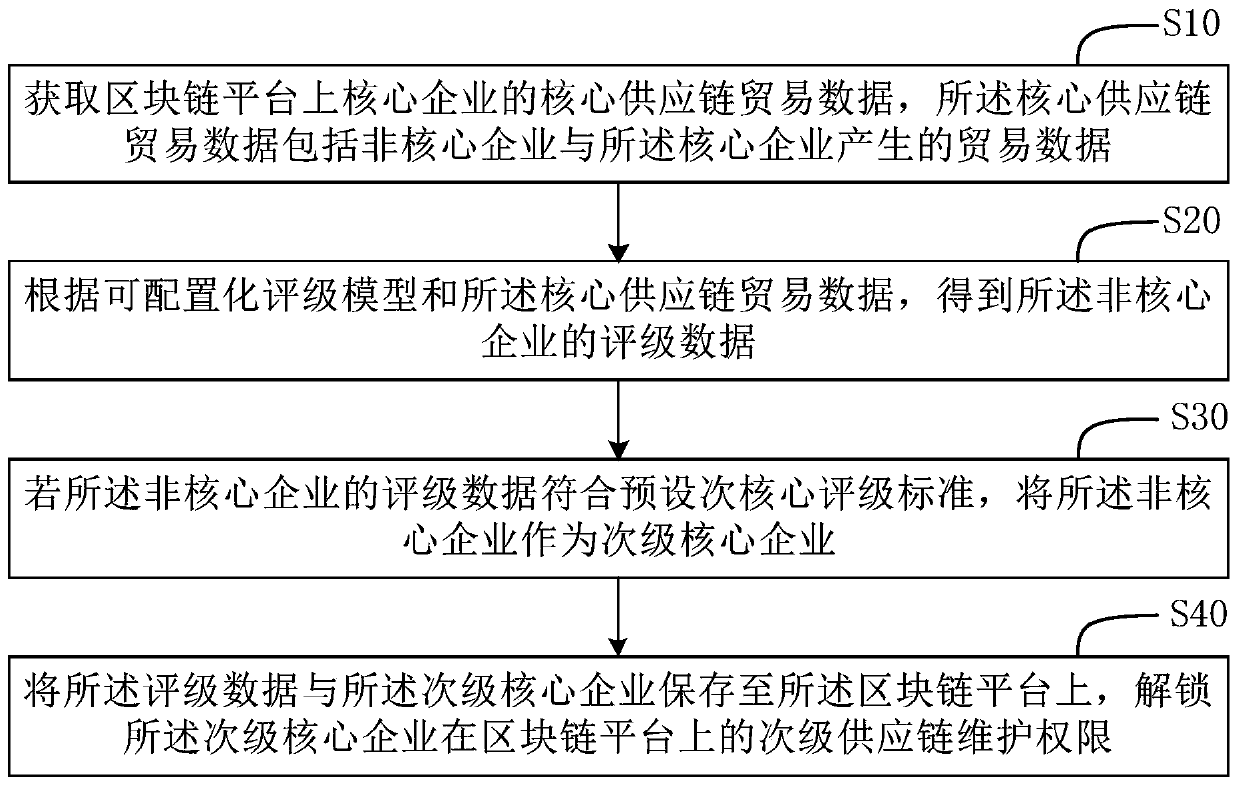

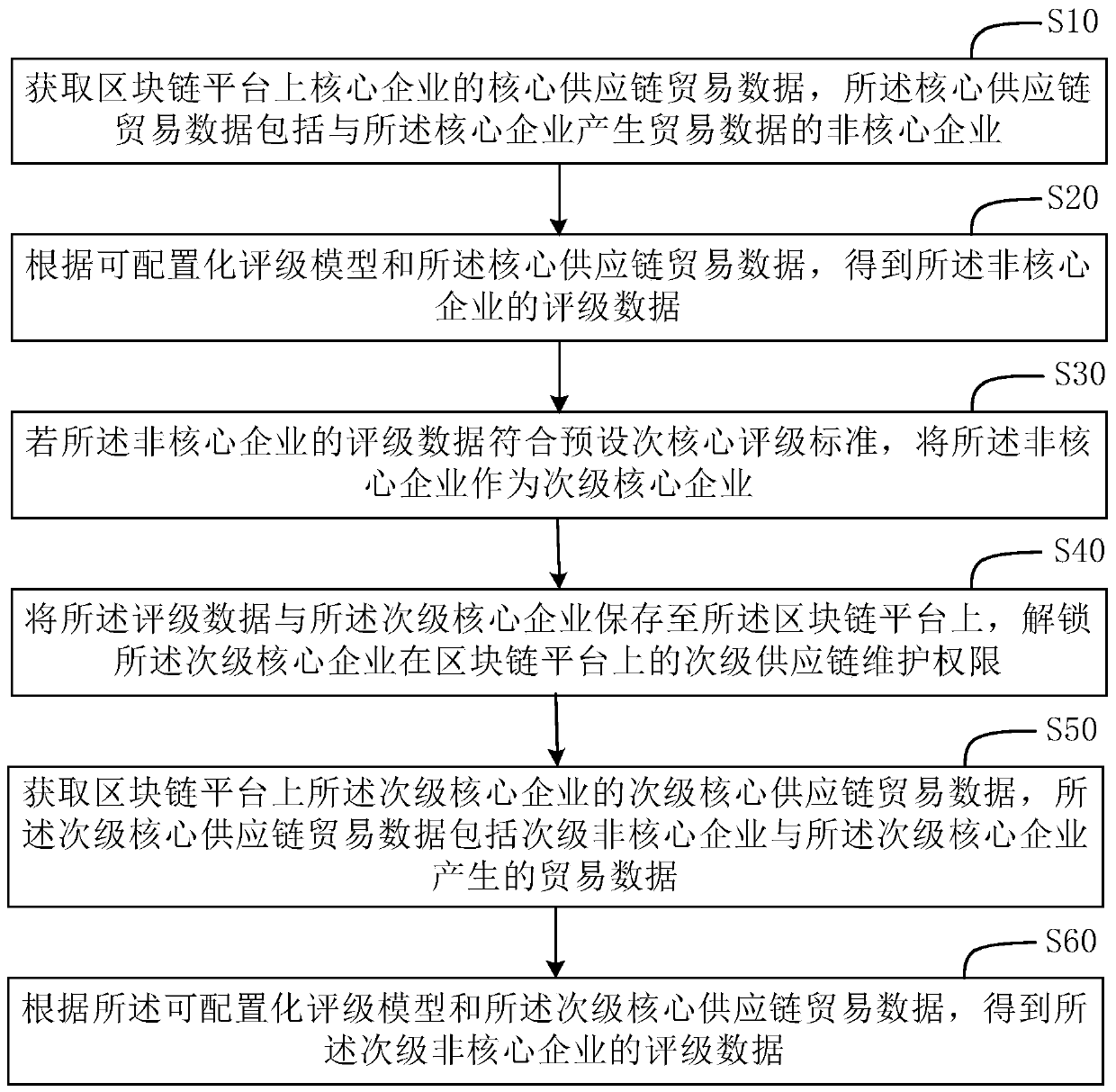

Supply chain financial evaluation method and device, storage medium and terminal

PendingCN110070432AGuarantee authenticityBreak through blockageFinanceResourcesComputer terminalComputer science

The invention provides a supply chain finance evaluation method and device, a storage medium and a terminal, the supply chain finance evaluation method comprises the following steps: obtaining core supply chain trade data of a core enterprise on a block chain platform, the core supply chain trade data comprising trade data generated by a non-core enterprise and the core enterprise; obtaining rating data of the non-core enterprise according to a configurable rating model and the core supply chain trade data; if the rating data of the non-core enterprise meets a preset sub-core rating standard,taking the non-core enterprise as a secondary core enterprise; and storing the rating data and the secondary core enterprise on the block chain platform, and unlocking the secondary supply chain maintenance authority of the secondary core enterprise on the block chain platform. Secondary core enterprises can be screened out, a secondary supply chain is established through the secondary core enterprises, forming of a new supply chain is facilitated, and self-development ecology is formed.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

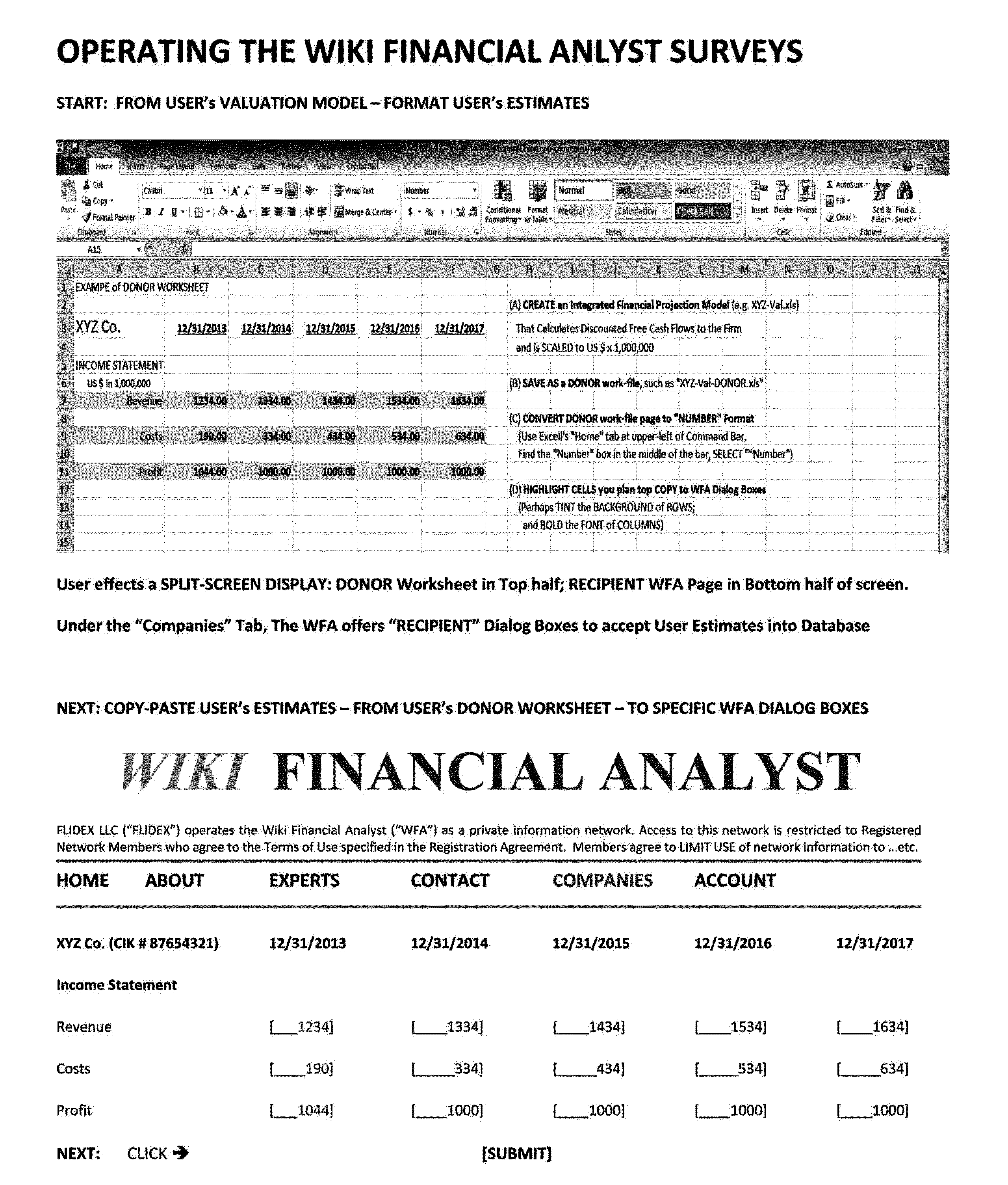

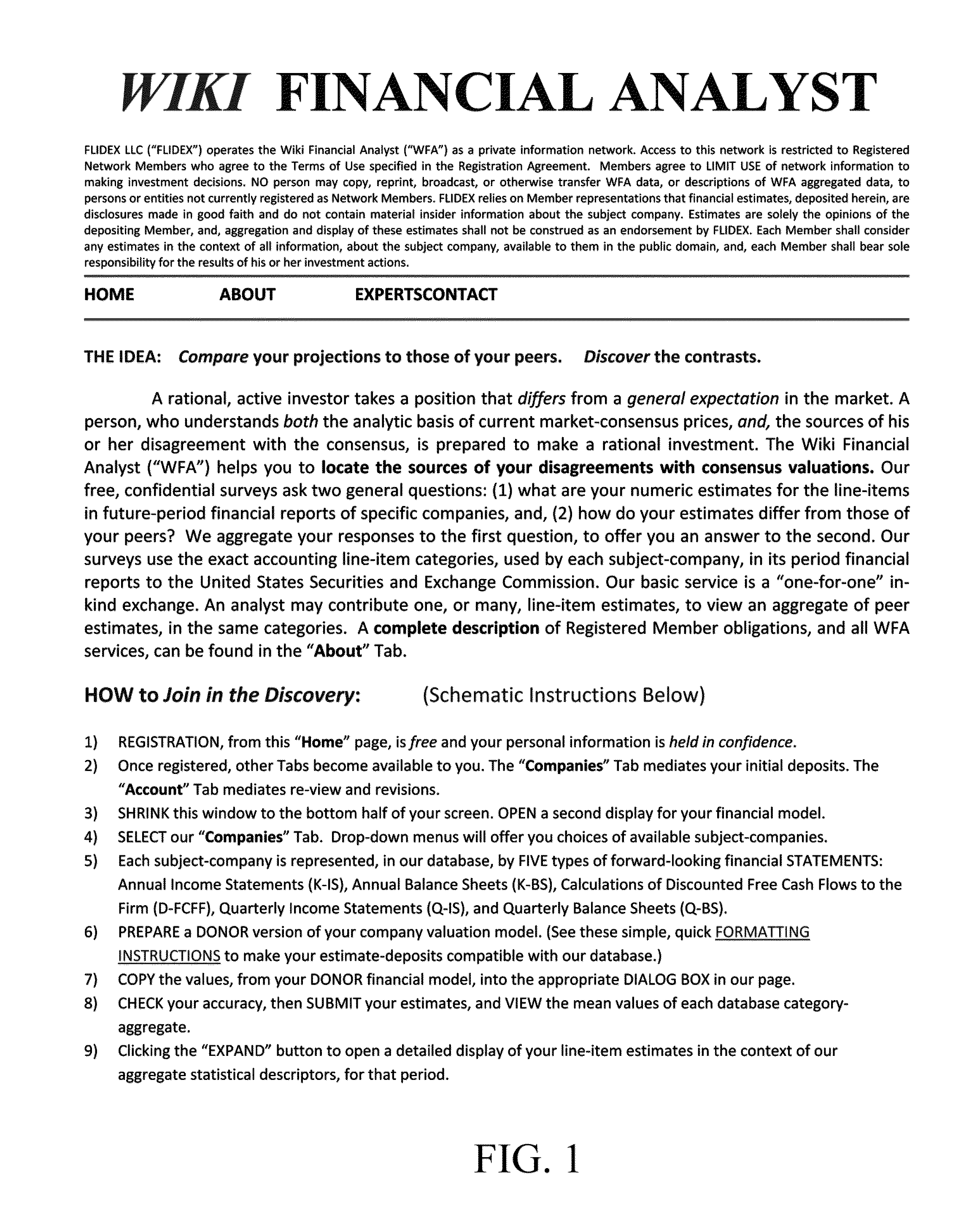

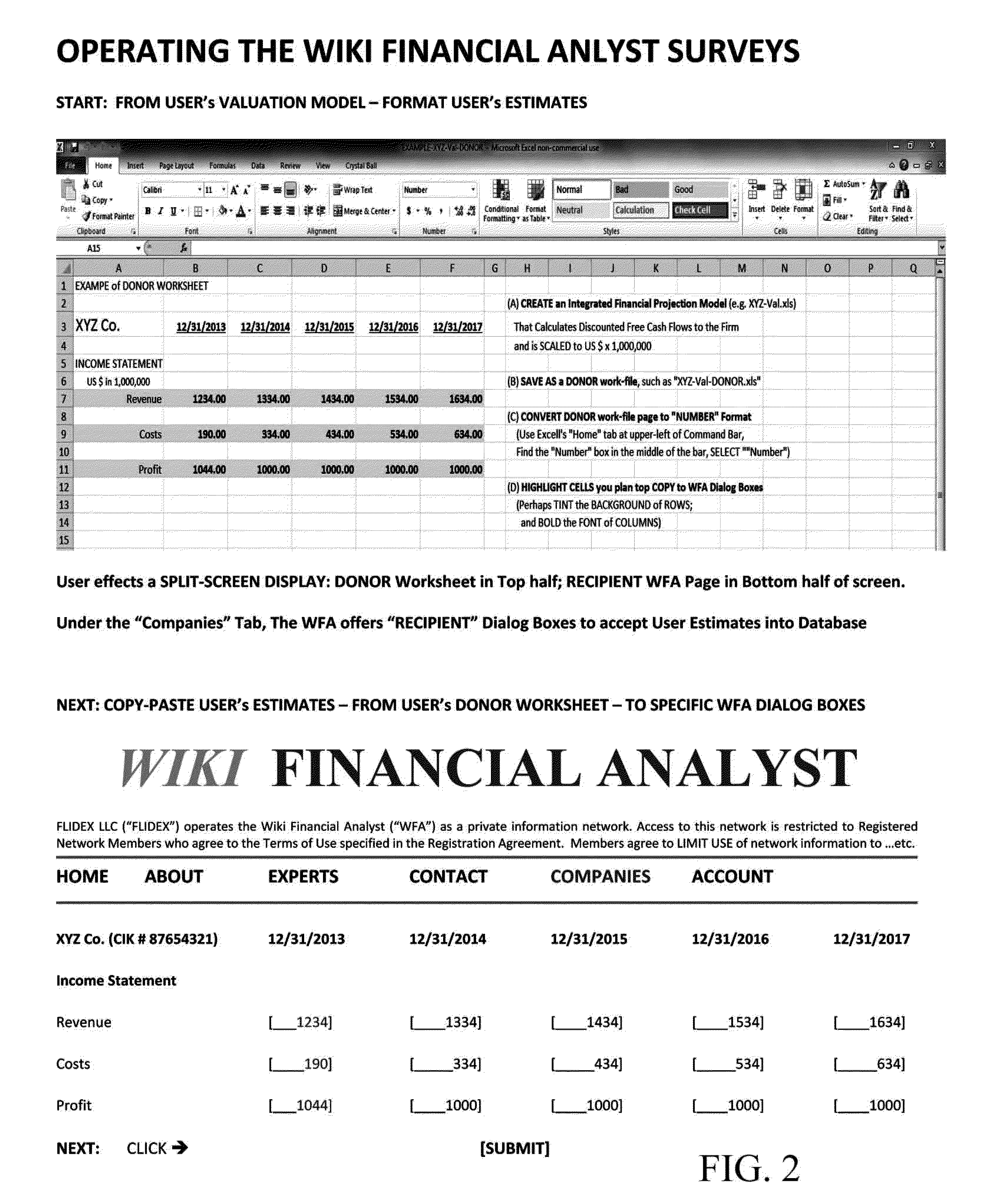

Method and system automates a comprehensive, on-going survey of forward-looking financial estimates entering projected financial statements and valuation calculations

InactiveUS20140279328A1Improve accuracy and stabilityEasy to useFinanceForward lookingComputer software

The invention embodies a method, and computer software, that automates comprehensive surveys of forward-looking numeric estimates, in financial valuation models, of companies that report period financial results to the United States Securities and Exchange Commission (US SEC). The method provides an immediate, in-kind exchange of financial information, so that a participant may compare his or her individual estimates, to an aggregation of peer estimates, in the same categories. The method specifies survey categories as: (i) the exact accounting categories used by the company in its period financial reports to the US SEC, or, (ii) the exact adjustments used to convert “accrual accounting” values to the “cash accounting” values used in the valuation method of “discounting free cash flows to the firm”. The claim specifies test criteria for: fidelity to the accounting categories of the reporting company; comprehensiveness of the survey; and, an immediate feed-back of in-kind information to participants.

Owner:PENDEM LAXMISEKAR +1

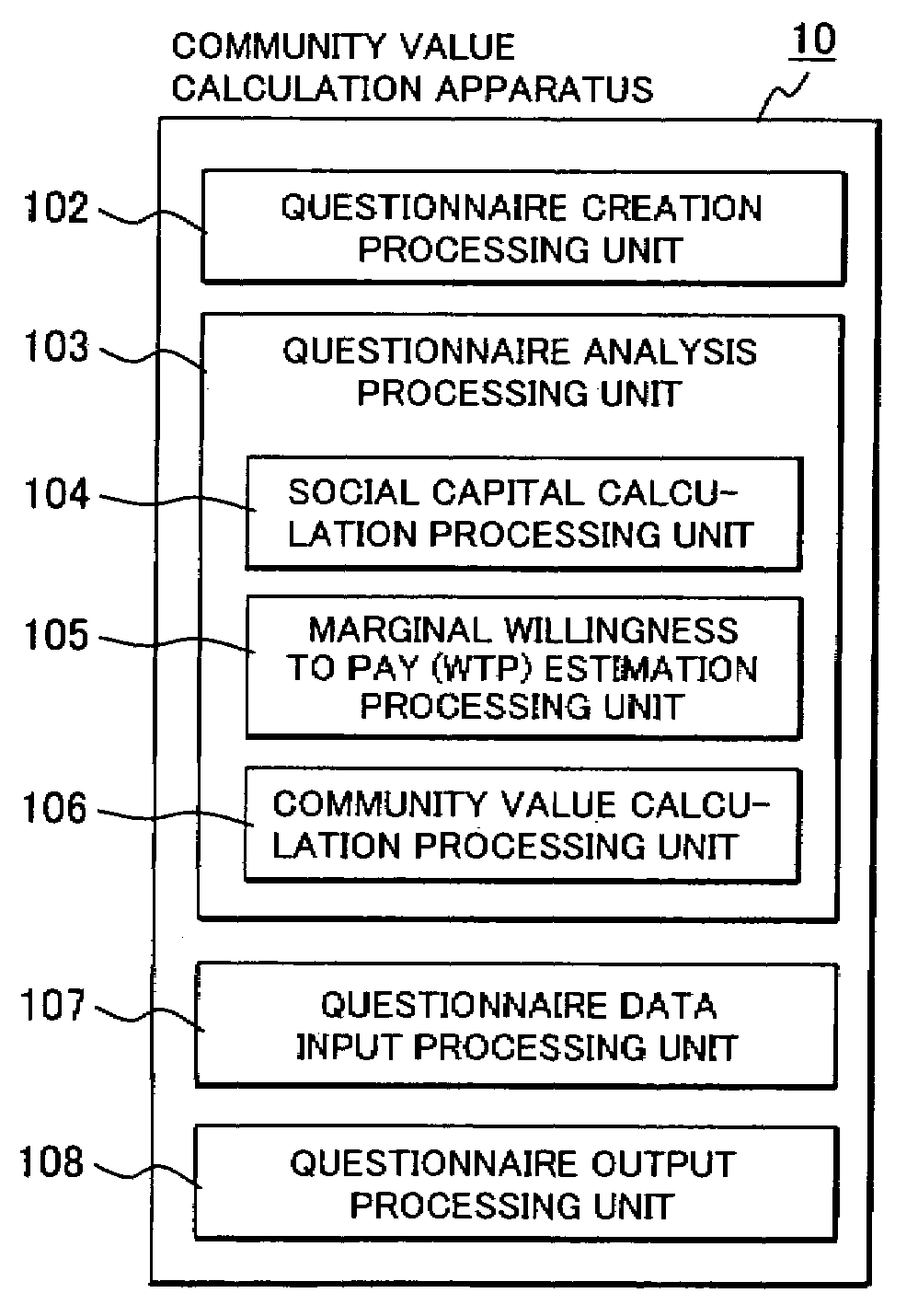

Community value calculation method and community value calculation system

With respect to social capital, since no market exists to deal with the social capital itself, financial evaluation based on cash flow cannot be performed.Profiles are created according to service attributes of services in a community. Then, members in a regional society are requested to selects one of the profiles and a questionnaire survey is conducted concerning actual situations of services in a community. Social capital indices are computed based on data collected in the survey, willingness to pay (WTP) is estimated for each service of the community in the regional society based on the social capital indices and the questionnaire data. Thereafter, to calculate a community value, one of the service attributes is designated and a difference among calculated marginal WTP values of some regional societies is evaluated as a financial value of social capital.

Owner:HITACHI LTD

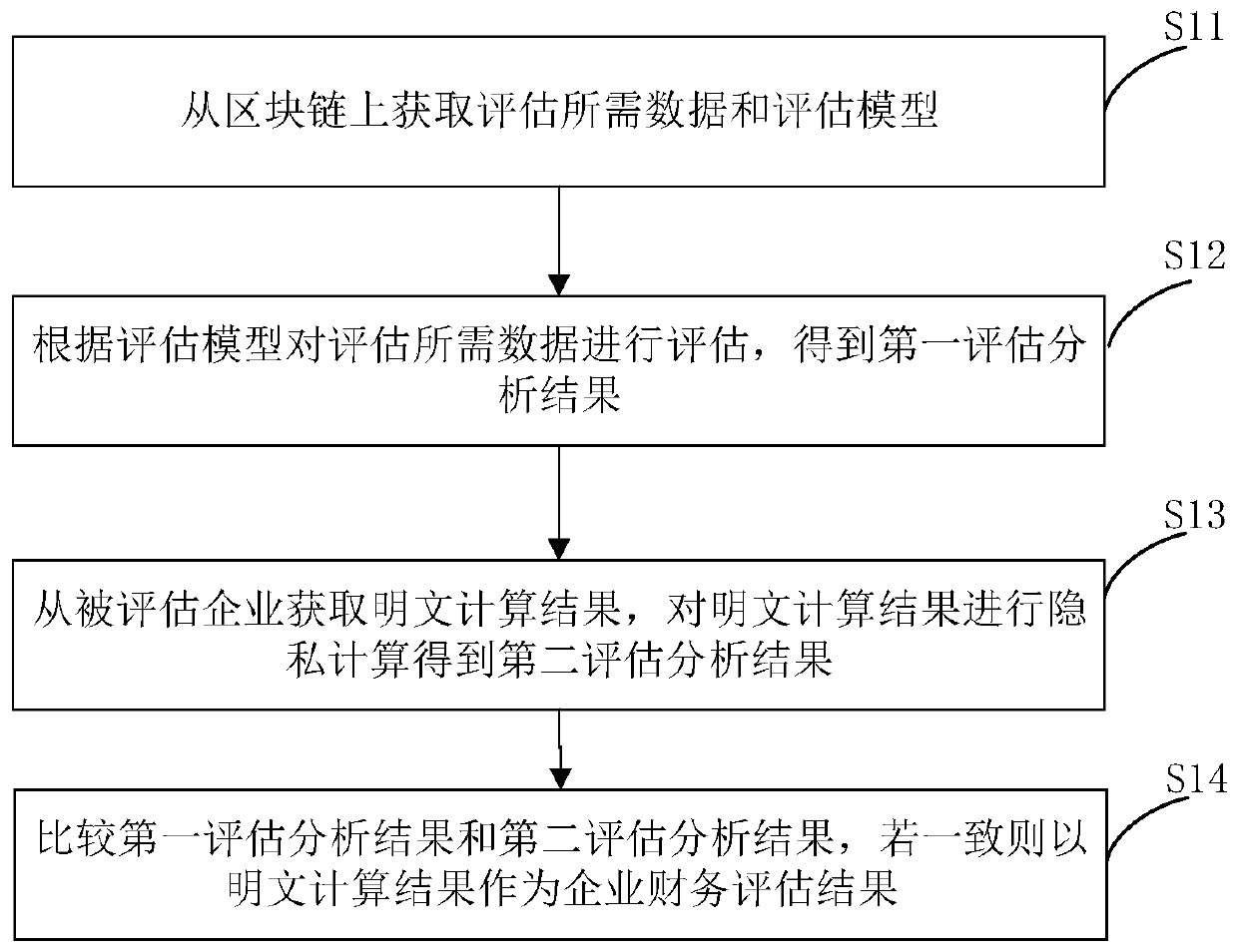

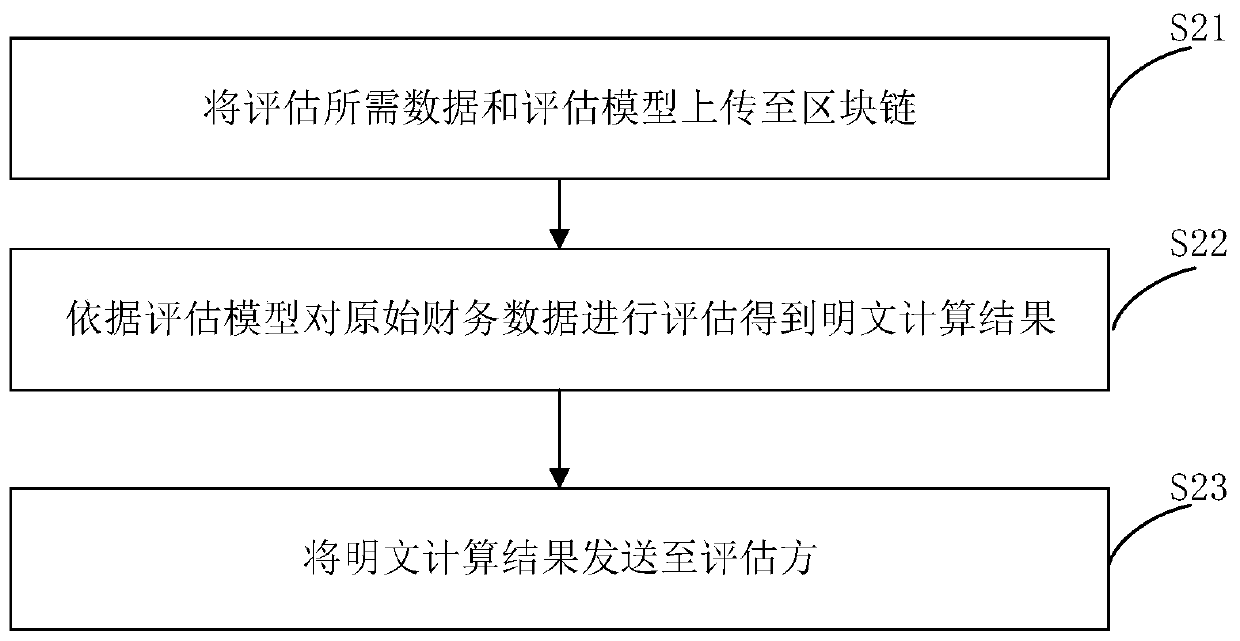

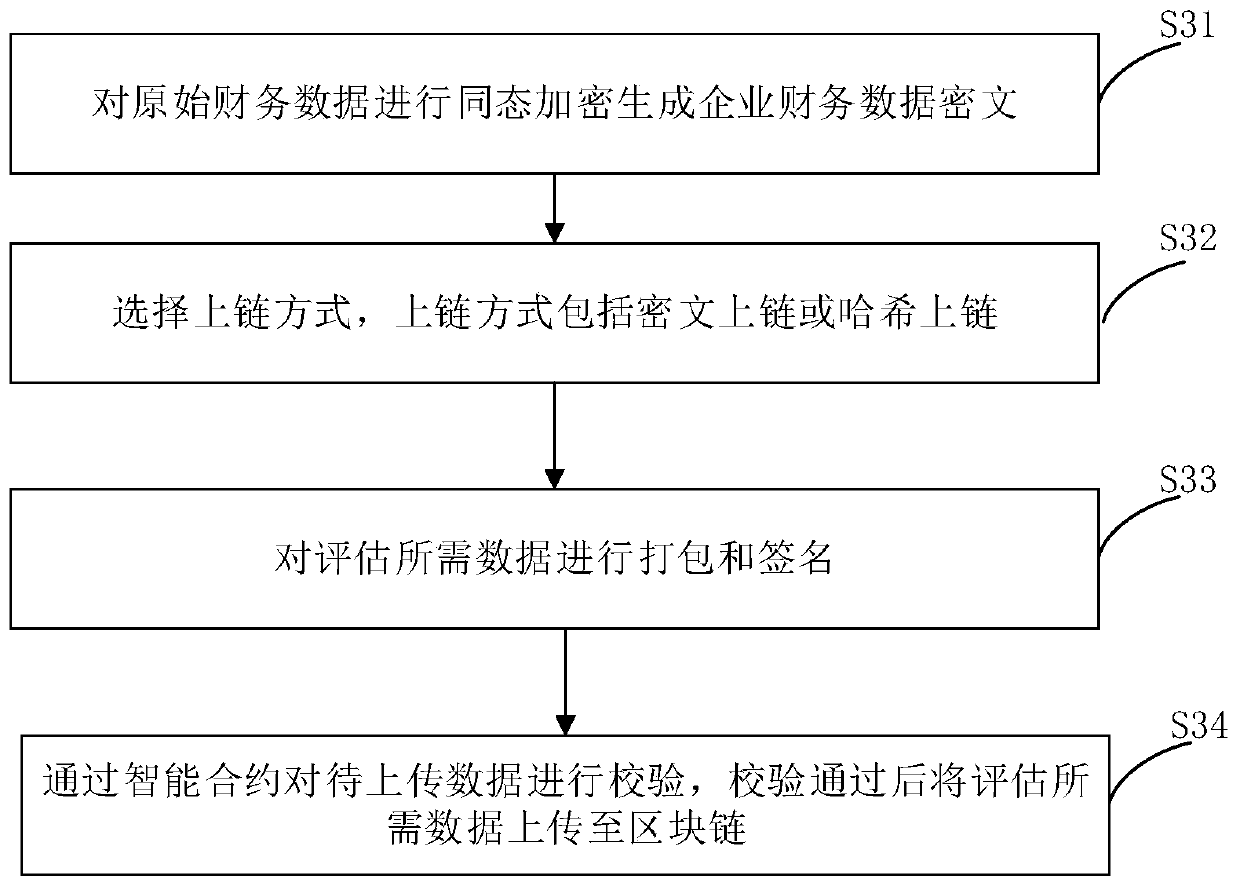

Financial evaluation method and evaluation system based on blockchain

PendingCN111242453AGuaranteed privacyWill not affect operationsFinanceDigital data protectionEvaluation resultBusiness enterprise

The invention relates to a financial evaluation method and evaluation system based on blockchain. The financial evaluation method based on the blockchain comprises the steps: acquiring data and an evaluation model required by evaluation from the blockchain; evaluating the data required for evaluation according to the evaluation model to obtain a first evaluation analysis result; obtaining a plaintext calculation result from an evaluated enterprise, and performing privacy calculation on the plaintext calculation result to obtain a second evaluation analysis result; comparing the first evaluation analysis result with the second evaluation analysis result, and if the results are consistent, taking a plaintext calculation result as an enterprise financial evaluation result. According to the application, financial data of an enterprise can be protected from being disclosed, financial evaluation can be automatically completed on the blockchain under the condition of not revealing business secrets of the enterprise, timeliness and authenticity required by an evaluator are met, operation activities of the enterprise are not affected, and the accuracy of an evaluation result can be improvedby verifying an evaluation result of an evaluation party.

Owner:通链(北京)科技有限公司

An economic evaluation method of a coal mine gas control trusteeship mode project

The invention relates to an economic evaluation method of a coal mine gas control trusteeship mode project, comprising the following steps: S1, compiling enterprise quota according to enterprise personnel quality, mechanical equipment degree, technology and management level, etc.; S2: Calculating the engineering cost, including the total income and total cost of the gas control custody project, and the calculation method of the engineering cost adopts the bill of quantities method; S3: performing financial evaluation, obtaining the capital inflows and outflows from the beginning to the end ofthe project, as well as the predicted results of various economic indicators; S4: performing Sensitivity analysis, including unit price of engineering construction subcontracting, engineering construction quantity and collection period; S5: performing Risk evaluation; S6: performing Comprehensive evaluation, through the financial evaluation, uncertainty analysis of the project financial evaluationclassification, combined with the project risk quantitative evaluation of the project risk classification, performing comprehensive evaluation of the gas control engineering project,judging the feasibility of the project, and providing targeted measures.

Owner:CHINA COAL TECH & ENG GRP CHONGQING RES INST CO LTD

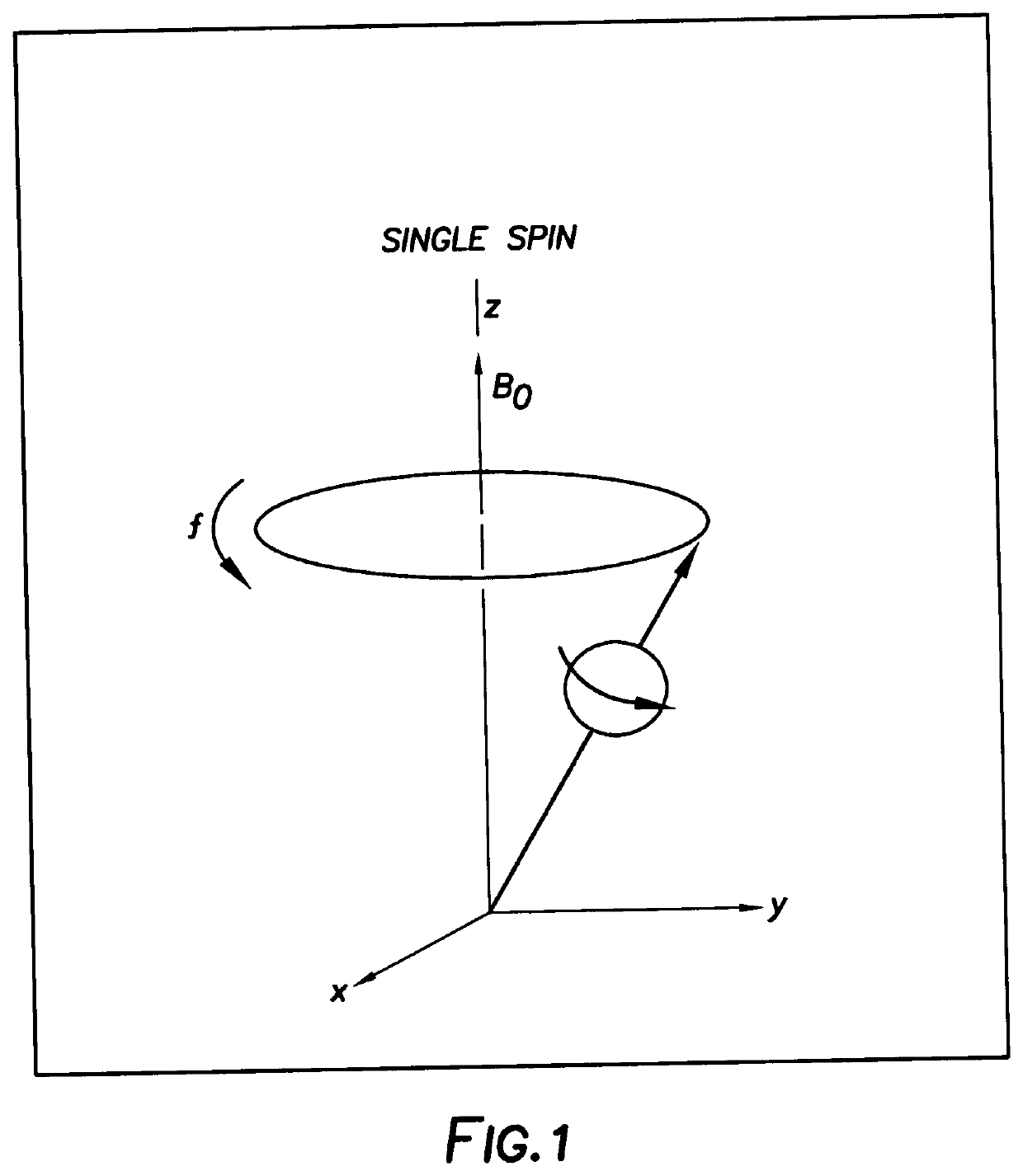

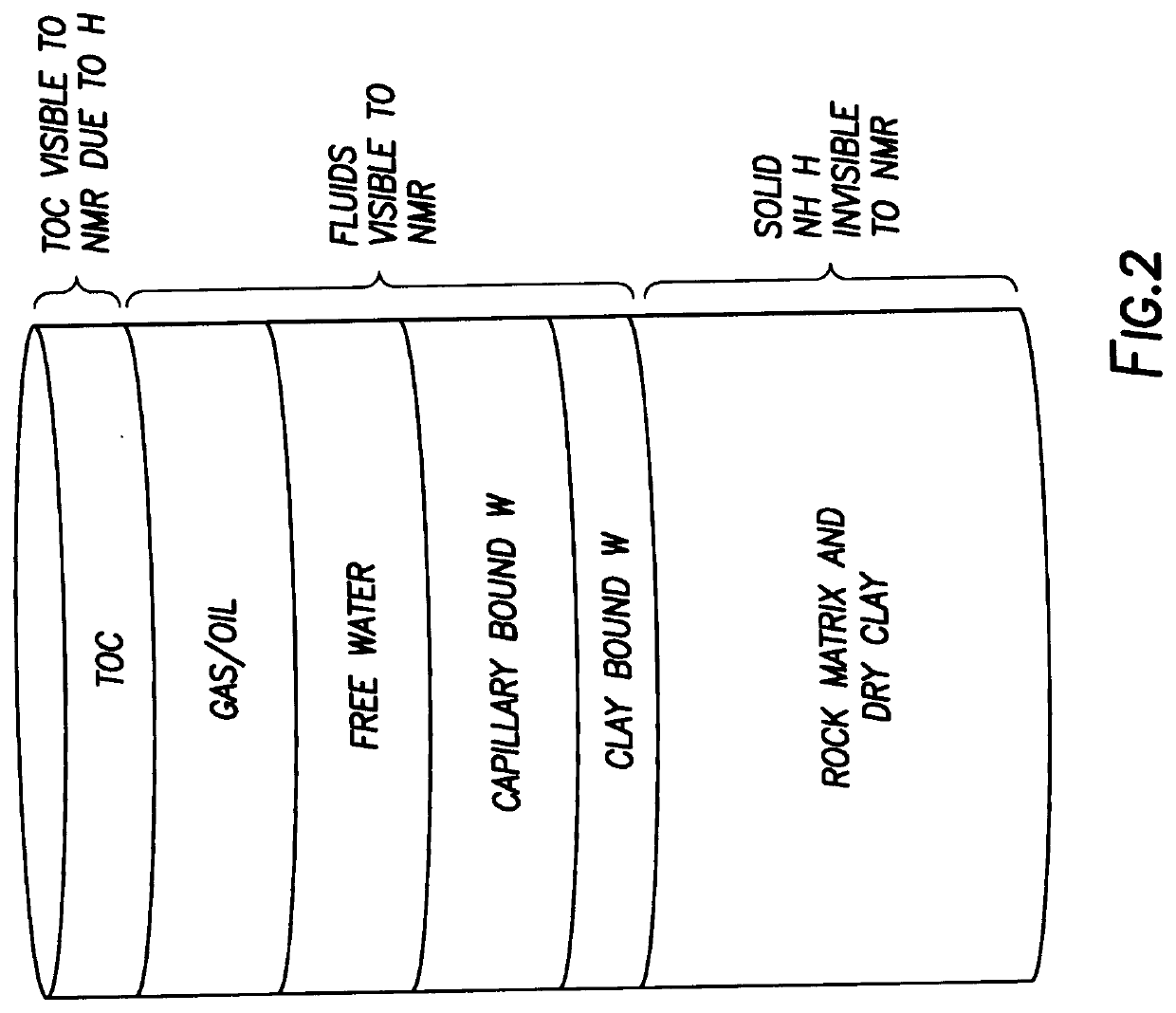

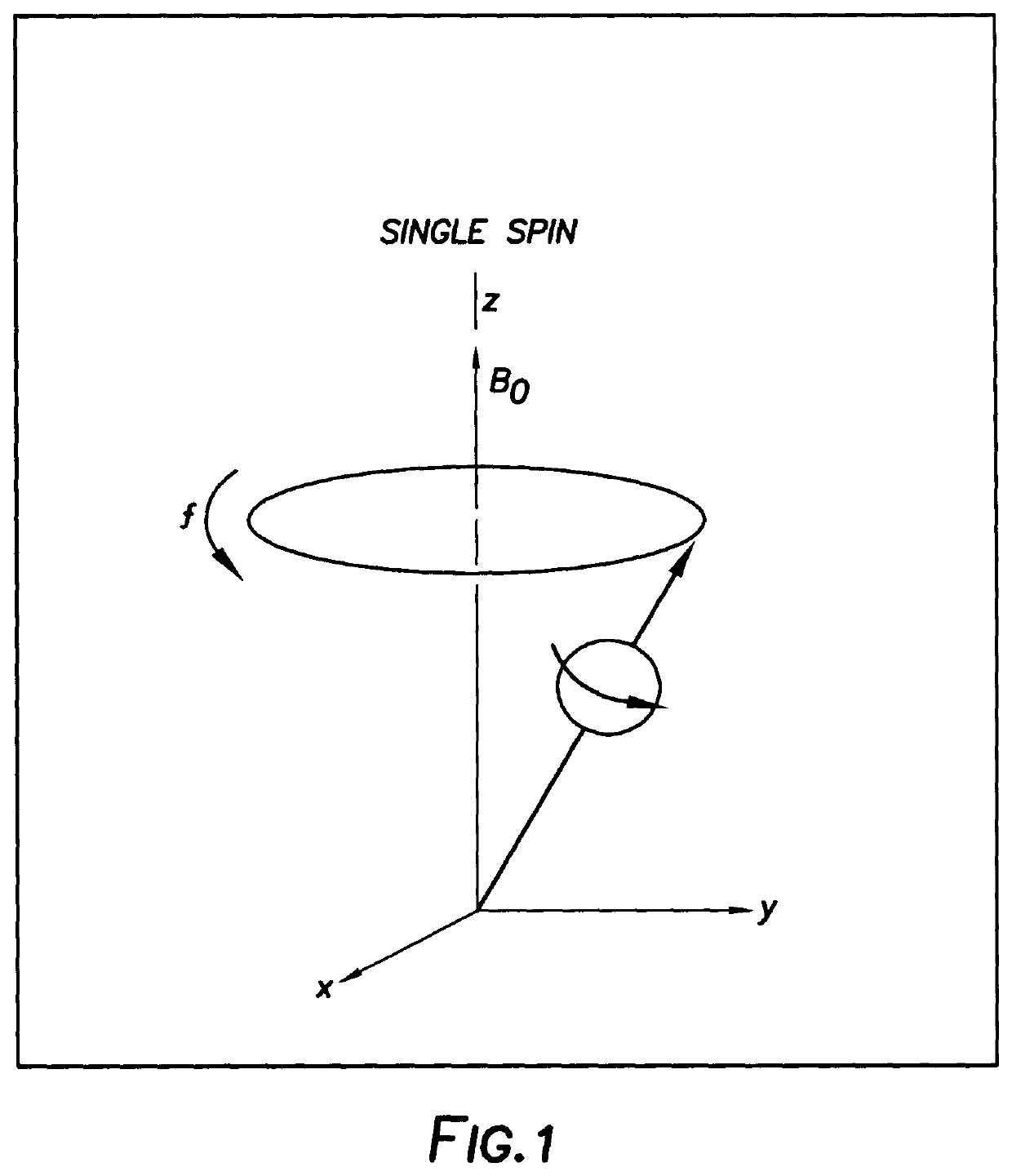

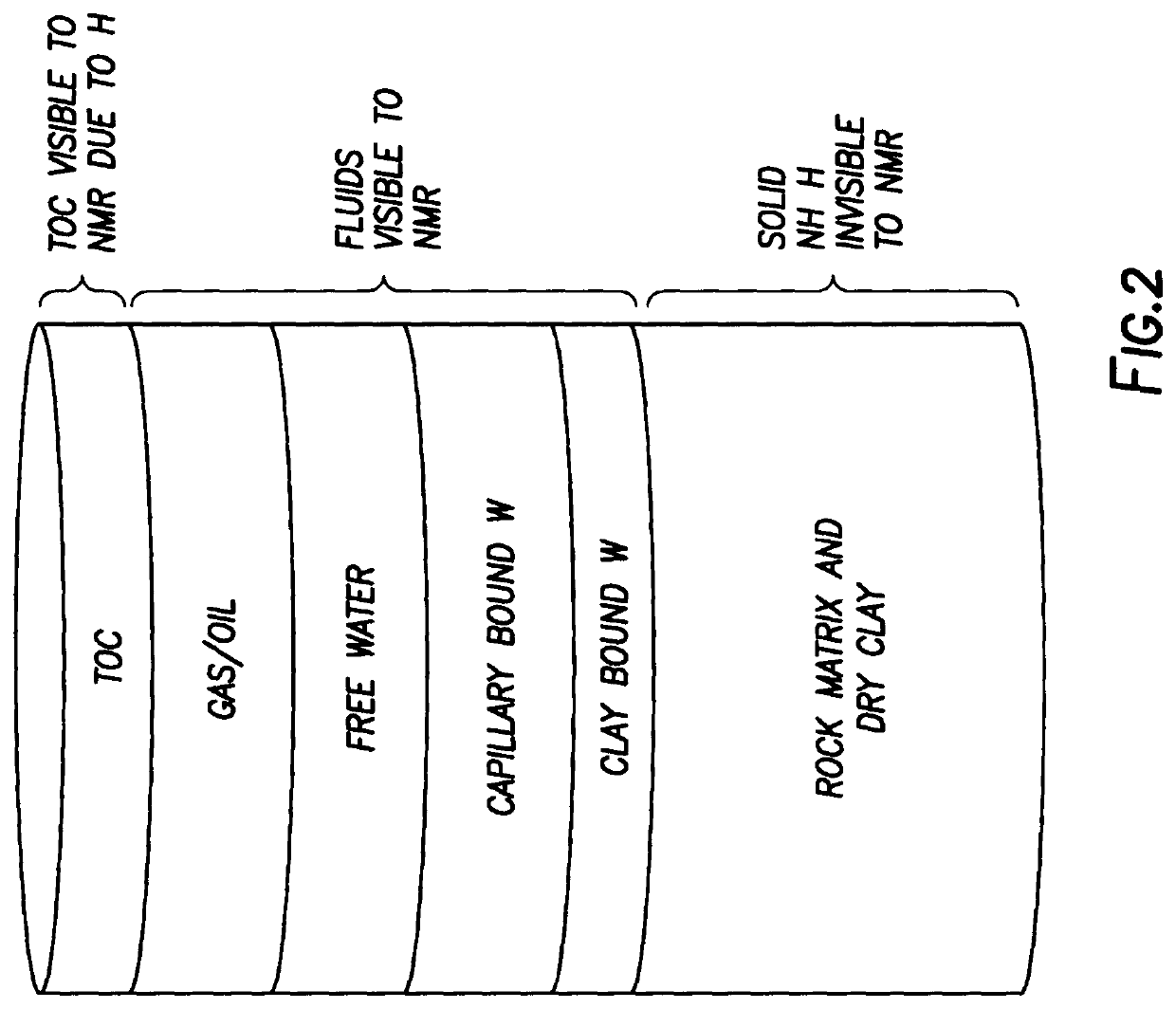

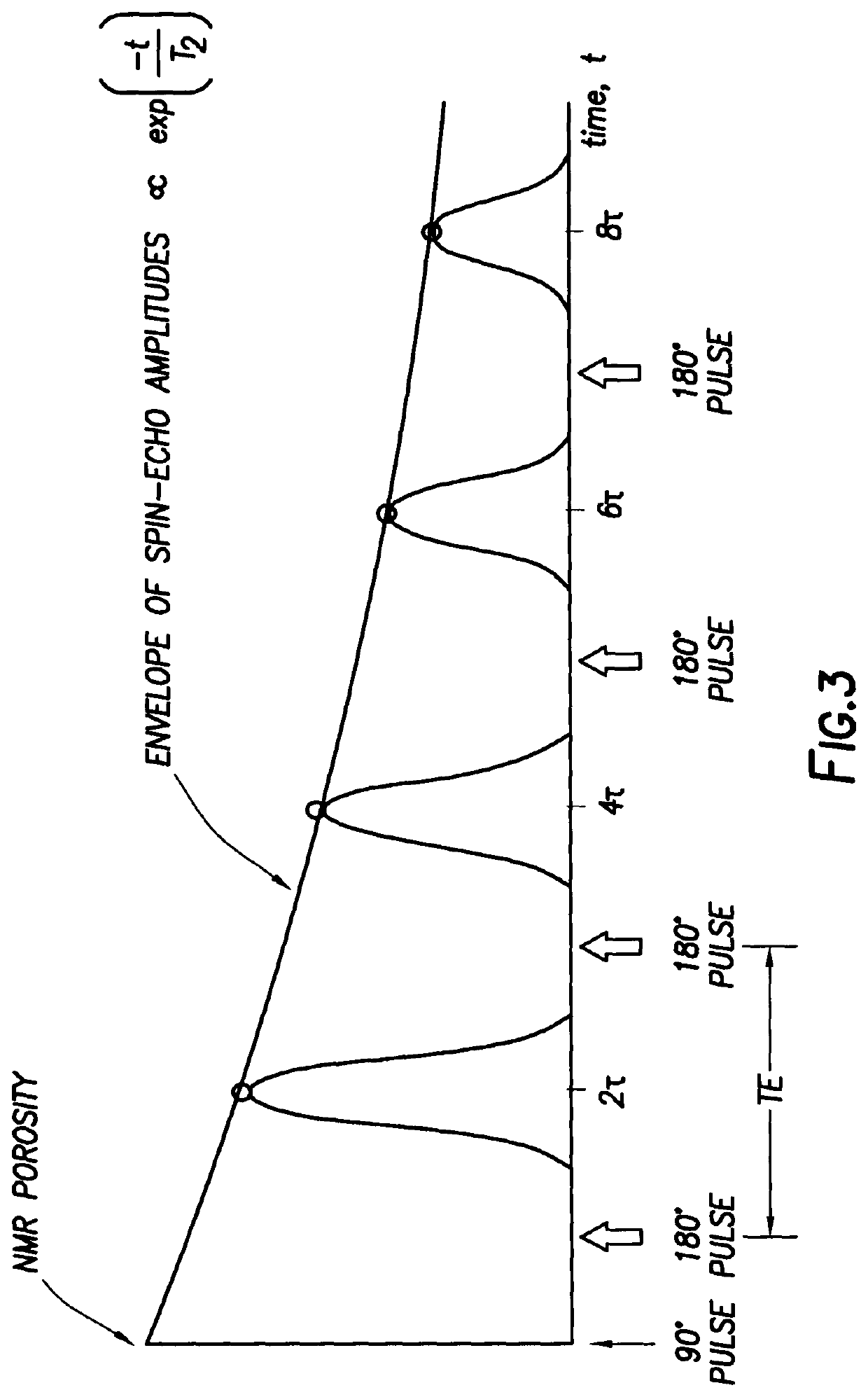

Nmr sequential fluid characterization

ActiveUS20200264116A1Analysis using nuclear magnetic resonanceMeasurements using NMRHydrocotyle bowlesioidesPhysical chemistry

Methods and systems for determining location of hydrocarbon in unconventional plays are provided. The methods comprise at least two steps of measuring formation samples as received, as dried and / or as saturated using high resolution NMR, and subsequent processing of the NMR data to determine one of several formation properties or components where the formation property or the component can be used to locate an oil or gas reservoir, complete a well, and / or increase production efficiency. Also, the present methods provide a series of sequential and ordered combination of steps related to the financial evaluation of number of barrels of oil or cubic feet of gas which can be produced at a location.

Owner:SOUTHWESTERN ENERGY CO

NMR sequential fluid characterization

ActiveUS10900915B2Analysis using nuclear magnetic resonanceMeasurements using NMRHydrocotyle bowlesioidesPhysical chemistry

Owner:SOUTHWESTERN ENERGY CO

Comprehensive energy system natural gas power generation benefit calculation method

PendingCN111524014AReflect the benefit characteristics of power generationFinanceResourcesIntegrated energy systemProcess engineering

The invention discloses a comprehensive energy system natural gas power generation benefit calculation method, which comprises the steps of: establishing a natural gas power generation cost model; establishing a natural gas power generation benefit calculation model; selecting financial evaluation basic data and parameters; selecting the necessary financial evaluation basic data and parameters through research and prediction to perform cost and expense estimation and sales income and related tax, circulation funds and profit distribution estimation; compiling a related auxiliary report and a basic report, and measuring and calculating the profitability of a project; calculating financial evaluation indexes, and performing profitability analysis and debt paying capability analysis; and carrying out uncertain analysis to realize calculation of the natural gas power generation benefit of the comprehensive energy system. The comprehensive energy system natural gas power generation benefitcalculation method reflects benefit features of natural gas power generation, and has great guiding significance for calculation of the natural gas power generation benefit of the comprehensive energysystem and popularization of natural gas power generation.

Owner:SHANGHAI UNIVERSITY OF ELECTRIC POWER

Dynamic credit management

A method for providing a financial evaluation of at least one financial instrument or of an issuer supports the provision of a dynamic credit limit. A dynamic credit limit may be associated with a counterparty or a debt security of the counterparty, for example. The method includes obtaining counterparty credit quality data associated with a transaction of the financial instrument between a party and a counterparty. Debt market data is obtained where the debt market data is associated with or relevant to the transaction. A dynamic credit limit is determined for the counterparty or a financial instrument of the counterparty based on at least one of the inputted counterparty credit quality and the obtained debt market data. The dynamic credit limit may be defined in terms of a credit exposure versus time.

Owner:ACCENTURE GLOBAL SERVICES LTD

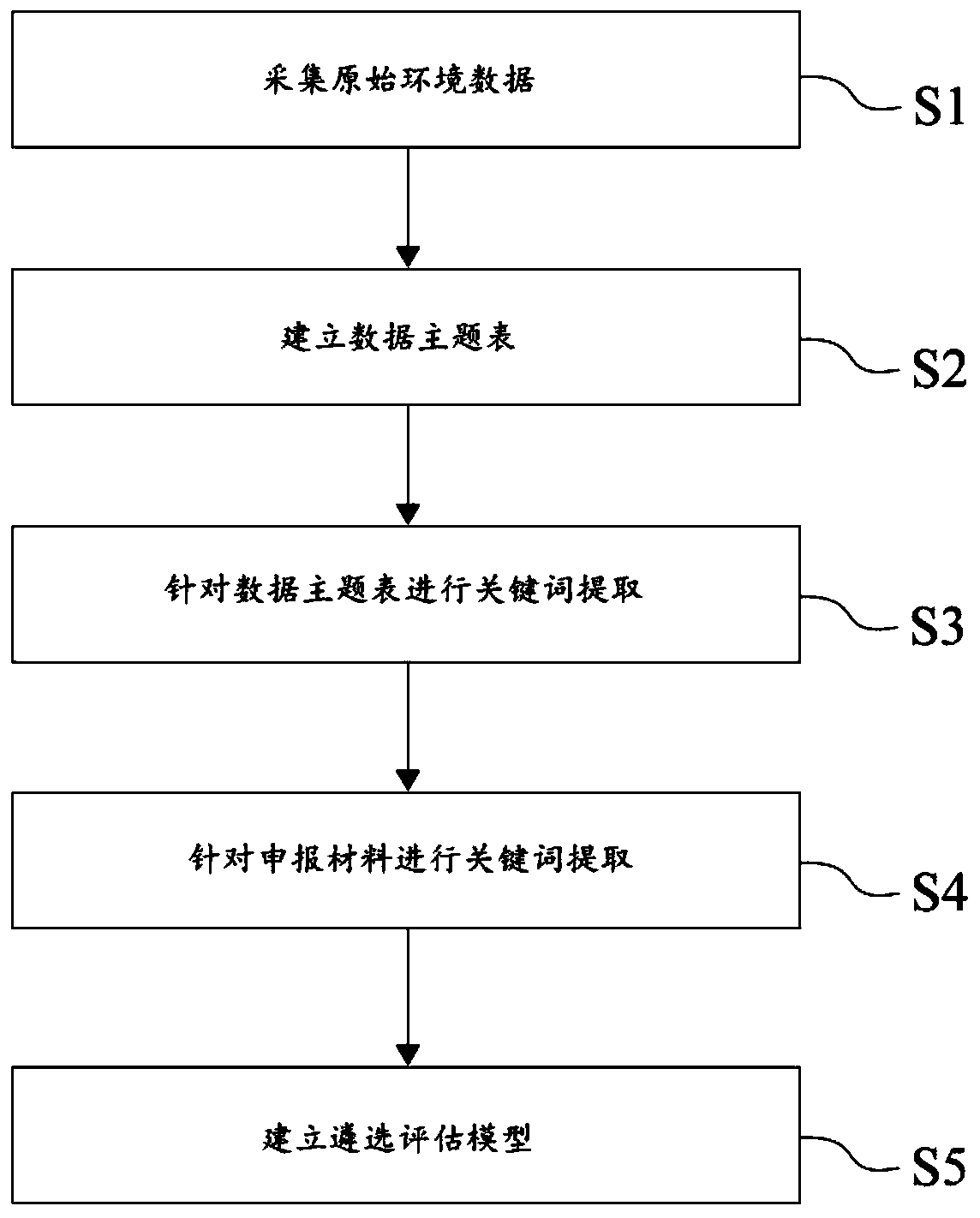

Green financial project selection evaluation method

The invention discloses a green financial project selection evaluation method. The method comprises the following steps: collecting original environment data; establishing a data topic table based onthe original environment data; carrying out keyword extraction on the data topic table to obtain a green standard keyword, a green condition limitation keyword and a non-green standard keyword, and obtaining a green standard knowledge base; carrying out keyword extraction on the declaration materials, and matching keyword on the basis of a green keyword knowledge base, so that a green project library is obtained; and establishing a selection evaluation model based on the green standard knowledge base and the green project library. According to the invention, the environmental data is classified and sorted, the green financial evaluation rules are sorted, and project evaluation is realized based on the selection evaluation model, so that related green financial decisions can be realized foran application evaluation unit.

Owner:厦门美契信息技术有限公司

Customized information pushing method and device and electronic equipment

PendingCN112347343AImprove accuracyReduce push costsDigital data information retrievalFinanceData packFeature data

The invention provides a customized information pushing method, which is used for pushing customized information to a user, and comprises the following steps: when an access request of a current useris received, obtaining user characteristic data of the user; performing target user screening according to the user feature data; constructing a real-time classification model, training the real-timeclassification model by using training data, the training data including user attribute data and financial performance data, and the financial performance data including credit granting data and dynamic branch data; calculating financial evaluation values of the screened target users by using a trained real-time classification model, and classifying the target users in real time; and pushing customized information to the user according to the financial prediction value of the target user. According to the method, the conversion rate is improved, the information pushing cost is effectively reduced, and the accuracy of customized information pushing is improved.

Owner:北京淇瑀信息科技有限公司

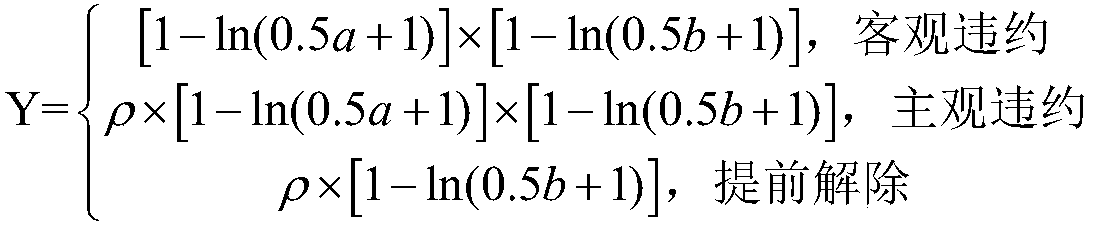

Power market risk evaluation and early warning method considering market subject remedial measures

InactiveCN111311036AEasy to identifyEvaluate credit statusResourcesMarket data gatheringMarket placeFinancial transaction

The invention discloses a power market risk evaluation and early warning method considering market subject remedial measures, and the method comprises the following steps: 1), obtaining a market subject long-term evaluation index according to the basic financial condition of a market subject; and 2) evaluating whether the market main body has a default condition or not after the transaction. 3) according to the remedial measures of the default subject and the time of taking the remedial measures, scoring the remedial measures of the market subject; 4) combining the market subject transaction behavior score with the market subject remedial measure coefficient, and calculating a market subject short-term evaluation index; and 5) applying the financial evaluation indexes and the transaction behavior evaluation indexes considering the remedial measures to the early warning measures. According to the method provided by the invention, a power market management department can identify risks caused by market subjects in advance, so that the power market management department can realize risk early warning; credit evaluation is carried out by combining remedial measures of main body defaultbehaviors afterwards, meanwhile, an afterwards risk prompt book is issued, and the market transparency is improved.

Owner:昆明电力交易中心有限责任公司

Clean heating transformation project mode optimization method and device

InactiveCN110705783ALow costLow running costForecastingResourcesProcess engineeringIndustrial engineering

The invention provides a clean heating transformation project mode optimization method and device. The clean heating transformation project mode optimization method comprises the steps of selecting financial evaluation parameters of all roles in all clean heating transformation project modes according to rights, responsibilities and interest concerns of all the roles in all the clean heating transformation project modes; calculating an evaluation value of each role in each cleaning and heating reconstruction project mode according to the financial evaluation parameters of each role in each cleaning and heating reconstruction project mode; selecting the clean heating transformation project mode based on the evaluation value of each role and the multi-objective optimization constraint condition, thus the optimal clean heating transformation project mode can be obtained, the cost of the clean heating project, especially the initial investment cost or operation cost of an electric heatinguser, is greatly reduced, and the government subsidy pressure and the enterprise investment pressure are relieved.

Owner:NORTH CHINA ELECTRICAL POWER RES INST +1

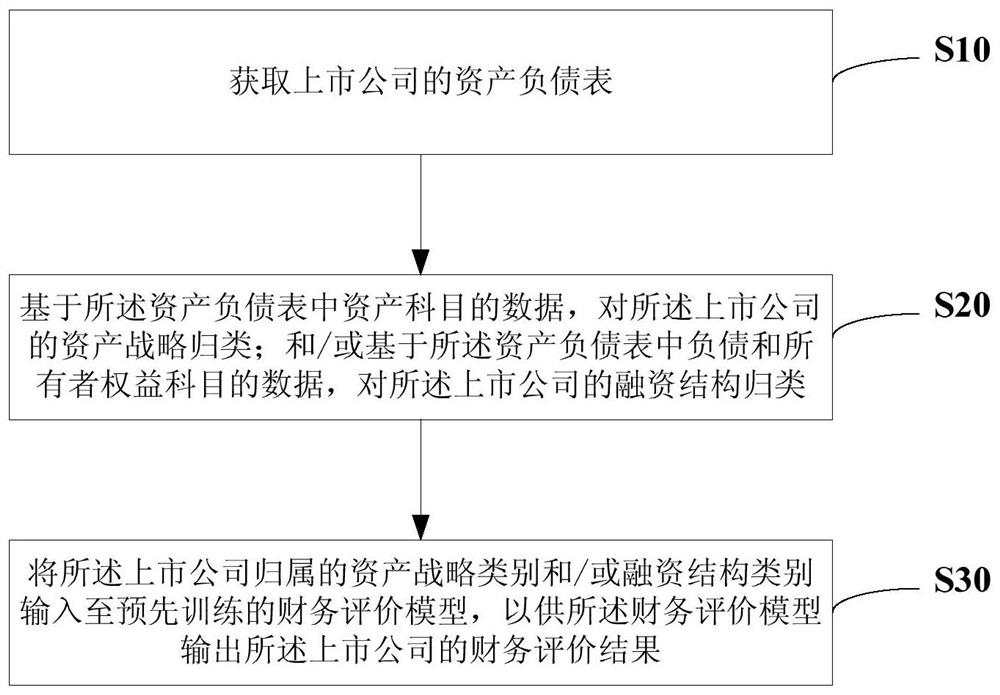

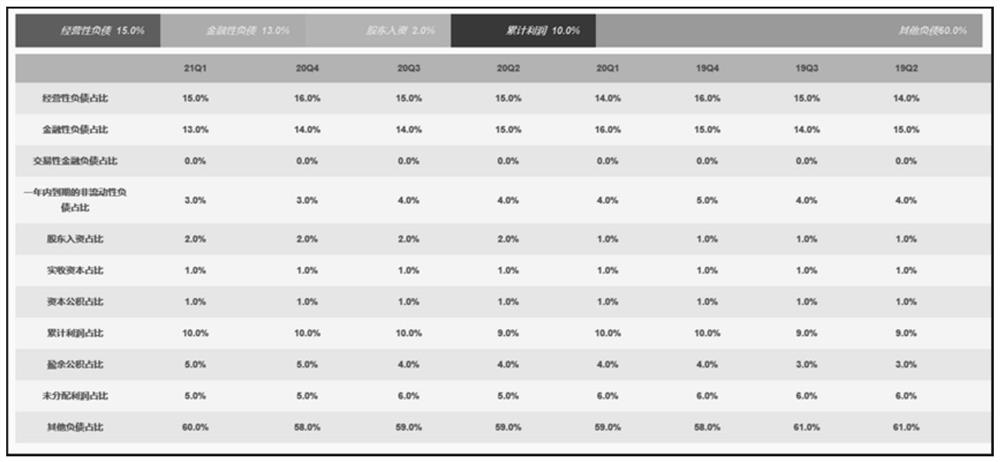

Listed company financial evaluation method and evaluation device, storage medium and electronic equipment

PendingCN114757753AAchieve growthRealize value creationFinanceResourcesEngineeringOperations research

The invention provides a listed company financial evaluation method and device, a storage medium and electronic equipment. The listed company financial evaluation method comprises the steps of obtaining an asset balance sheet of a listed company; based on data of asset subjects in the asset debt sheet, classifying asset strategies of the listed companies; and / or classifying financing structures of the listed companies on the basis of data of debts and owner right subjects in the asset debt sheet; and inputting the asset strategy category and / or the financing structure category to which the listed company belongs to a pre-trained financial evaluation model, so that the financial evaluation model outputs a financial evaluation result of the listed company. According to the method, internal and active strategic targets of the listed companies and external and passive investment values of the listed companies are quantitatively linked together for the first time, so that the profit, growth and value creation planned by the management level of the listed companies are more comprehensively evaluated to a great extent.

Owner:上海羽时互联网金融信息服务有限公司

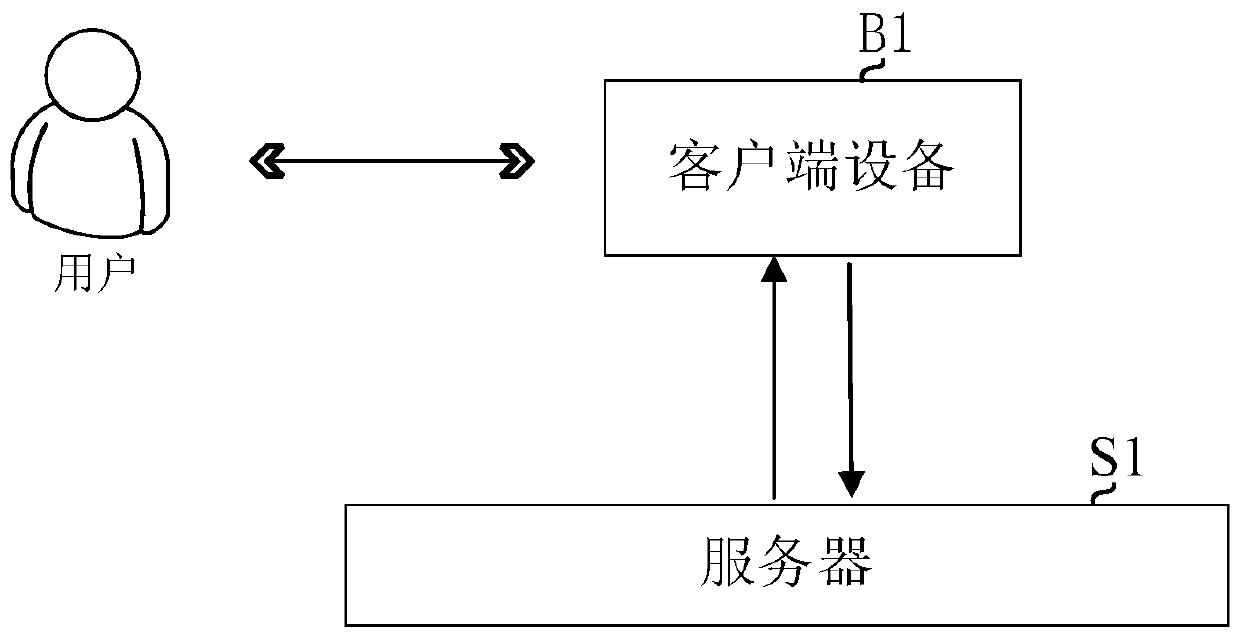

Financial revenue and expenditure evaluation system

ActiveCN110889090AOptimize allocationEffectively control financial revenue and expenditure risksFinanceResourcesComputer scienceOperations research

The invention relates to financial evaluation, and specifically relates to a financial revenue and expenditure evaluation system comprising a server, wherein the server is connected with a financial statement collection module used for collecting financial statements; the server is connected with a financial statement classification module for classifying the financial statements collected by thefinancial statement collection module; the server is connected with a financial data acquisition unit which is used for acquiring financial income data and financial expenditure data from the classified financial reports; the server is connected with a financial index import module used for importing current-stage income financial indexes and current-stage expenditure financial indexes from the storage module; and the server is connected with a data statistics module which is used for performing index completion rate statistics according to the related financial data acquired by the financialdata acquisition unit and the current-stage financial indexes imported by the financial index import module. According to the technical scheme provided by the invention, the defect that effective financial data acquisition and analytical statistics cannot be performed on financial reports in the prior art can be effectively overcome.

Owner:安徽天勤盛创信息科技股份有限公司

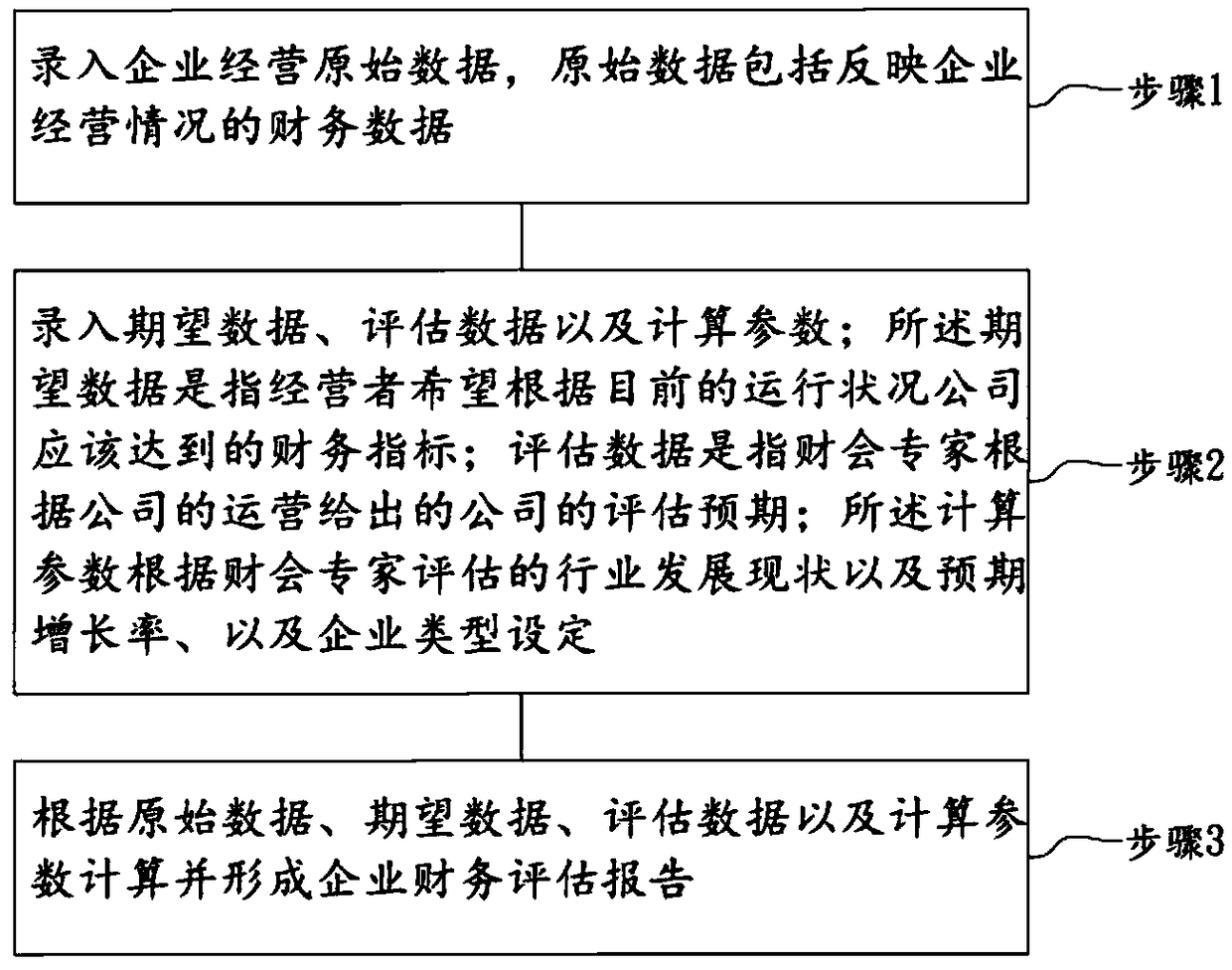

Financial analysis device and method

The invention discloses a financial analysis device and method. The device comprises an input module used for inputting expected data of an operator, the evaluation data of the operation condition byfinancial experts, the calculation parameters set by the financial experts; an original data module comprising financial data reflecting the operation condition of the enterprise; and an operation unit forming a financial evaluation report according to the expected data, the evaluation data, the original data, and the calculation parameter. The calculation parameter is set according to the industry development status of the financial expert evaluation, the expected growth rate and the type of the enterprise. According to the financial analysis device and method, a complete calculation parameter is formed according to the expected data, original data, and the evaluation data; and the operation unit calculates the obtained data to obtain the financial evaluation report. When the financial evaluation report performs re-evaluation for a class of enterprises without the intervention of financial experts, the cost is saved, and the evaluation is accurate.

Owner:深圳微企宝计算机系统有限公司

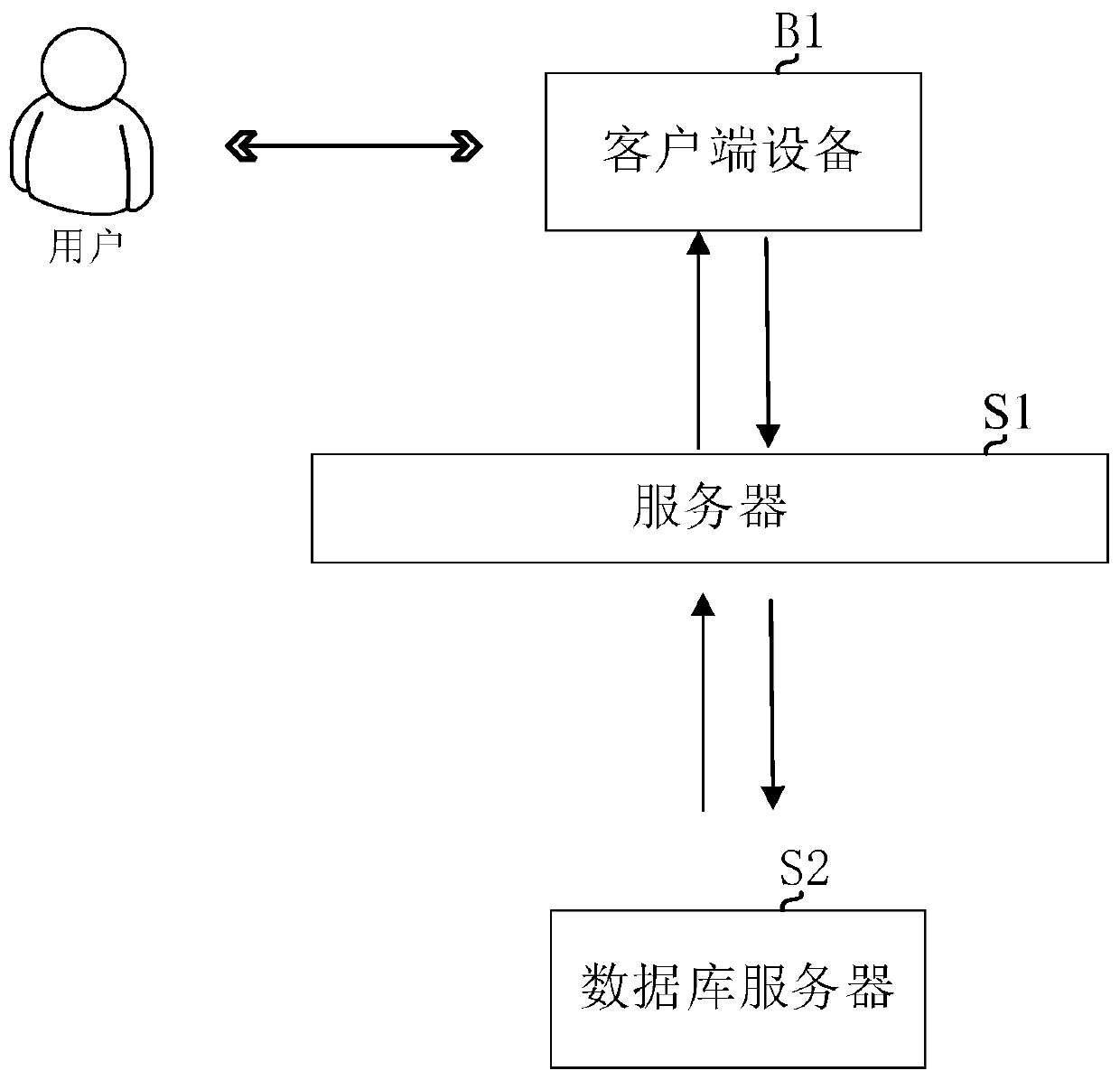

Pasture financial evaluation system

PendingCN113554348AClear development directionGain weight fastResourcesData acquisitionData acquisition module

The invention relates to a pasture financial evaluation system. The system comprises a data acquisition module, a data processing module, and an evaluation module; the data acquisition module is used for acquiring weights, quantities, and prices of different varieties of beef cattle; the data processing module is used for calculating values of different varieties of beef cattle by using a computer, recording the calculated value data in a database, processing the value data by using the computer, drawing a pie chart of value percentages of the different varieties of beef cattle, and obtaining a financial asset structure of a pasture; the evaluation module is used for sending the financial asset structure to a client end, collecting an initial financial asset evaluation result uploaded by the client end, and calculating a final financial asset evaluation result according to the initial financial asset evaluation result. The pasture financial evaluation system is advantageous in that the pasture financial evaluation system can be convenient for managers to quickly know a financial asset structure of a pasture and evaluate the pasture according to the financial asset structure of the pasture so as to clarify a future development direction of the pasture.

Owner:光谷金信武汉科技有限公司

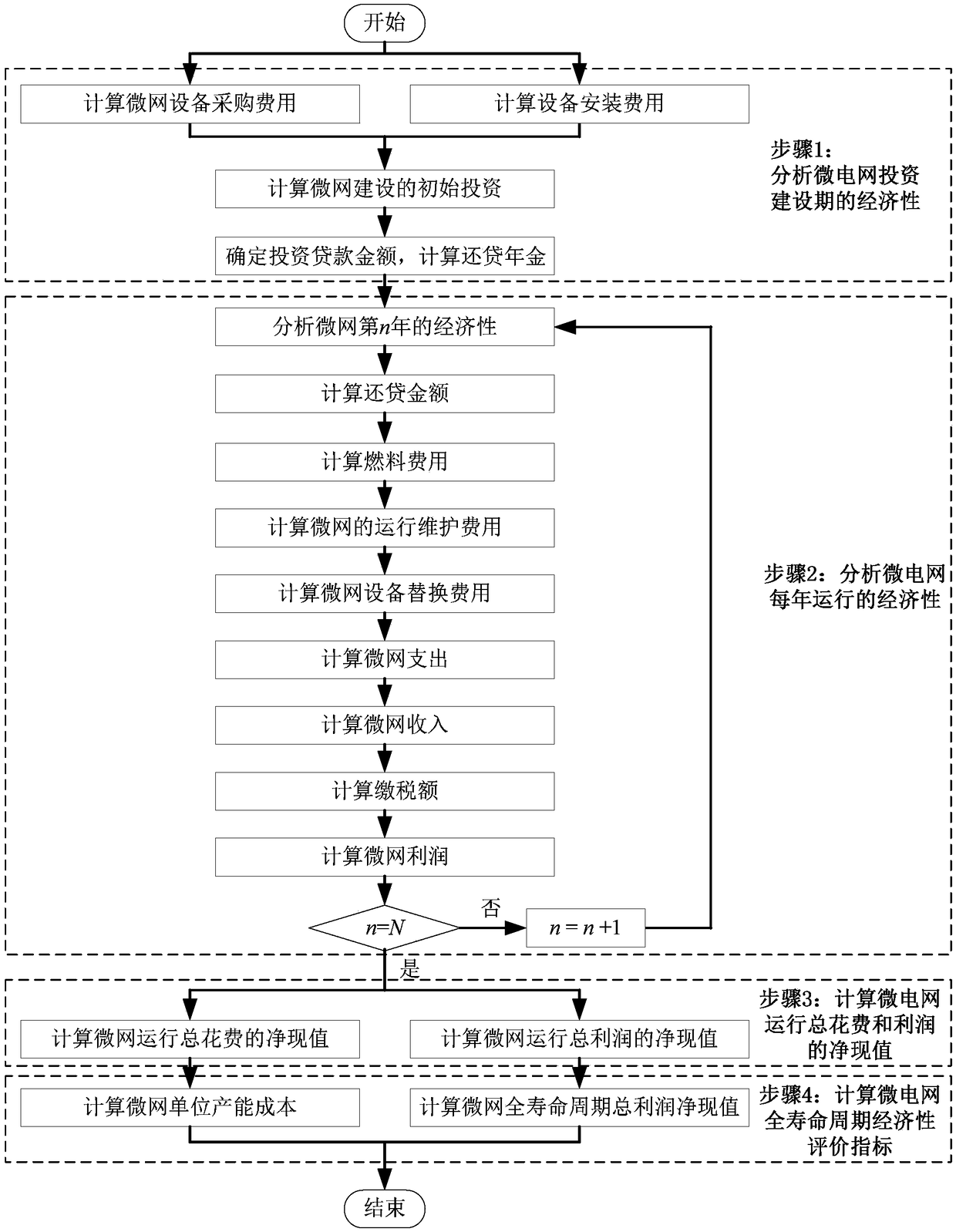

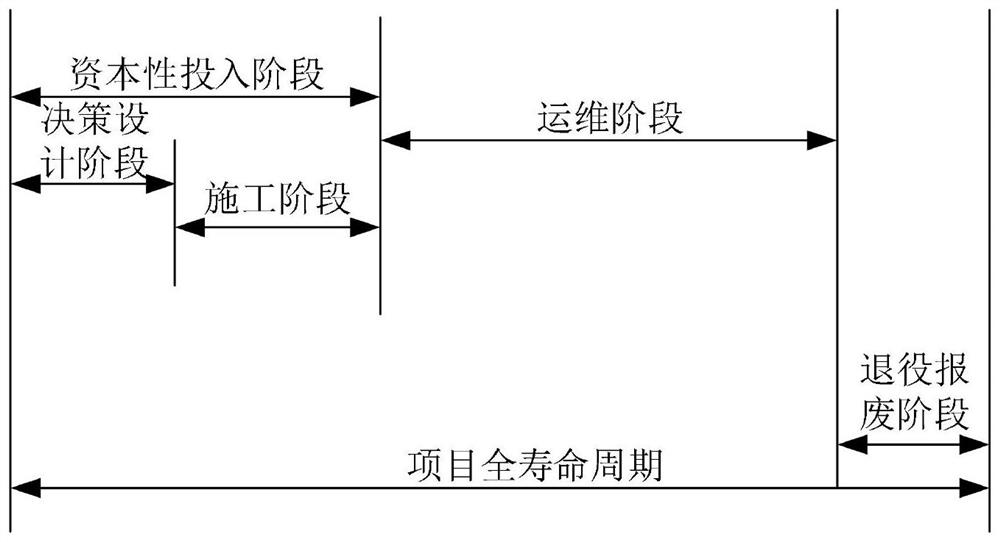

New energy-containing isolated microgrid life cycle economic evaluation method

The invention discloses a new energy-containing isolated microgrid life cycle economic evaluation method. The method comprises steps: the initial investment cost CS for construction of the isolated microgrid is calculated; the investment loan amount Cloan, the loan term TL and the interest rate i are determined, and the repayment annuity CRPa is calculated; economic index data for each year in theisolated microgrid life cycle are calculated; net present values Cnpv and Prnpv corresponding to the total expenditure and the profits for operation of the isolated microgrid are calculated; and lifecycle economic evaluation indexes of the isolated microgrid are calculated, wherein the indexes comprise the system life cycle total profit net present value and the system unit capacity cost. Basedon a life cycle theory, the shortcomings that the evaluation result obtained by the traditional project financial evaluation method is short in time scale and large in limitations can be overcome, andthe economic characteristics in the system life cycle can be described comprehensively and accurately; and due to calculation on operation, maintenance and device replacement cost for the isolated microgrid, the influences on the whole economy by the operation condition of the system can be effectively reflected.

Owner:STATE GRID TIANJIN ELECTRIC POWER +1

Comprehensive energy project full life cycle evaluation method and system

PendingCN113095696APromote the construction processEasy to useTechnology managementResourcesFull life cycleIntegrated energy system

The invention discloses a comprehensive energy project full life cycle evaluation method, and belongs to the field of comprehensive energy projects. The method comprises the steps: constructing a full-life-cycle cost and income quantitative model of a single component of the comprehensive energy project; establishing an evaluation index system of the comprehensive energy project, wherein the index system comprises financial evaluation and national economy evaluation; determining the weight of the index according to analytic hierarchy process; and performing fuzzy evaluation on the indexes to obtain comprehensive evaluation of the project. The invention has the beneficial effects that the cost income of the comprehensive energy project is quantified from the perspective of the full life cycle, the comprehensive evaluation system is established, and reference is provided for investment decision making of a comprehensive energy system investment subject.

Owner:NANJING ELECTRIC POWER ENG DESIGN

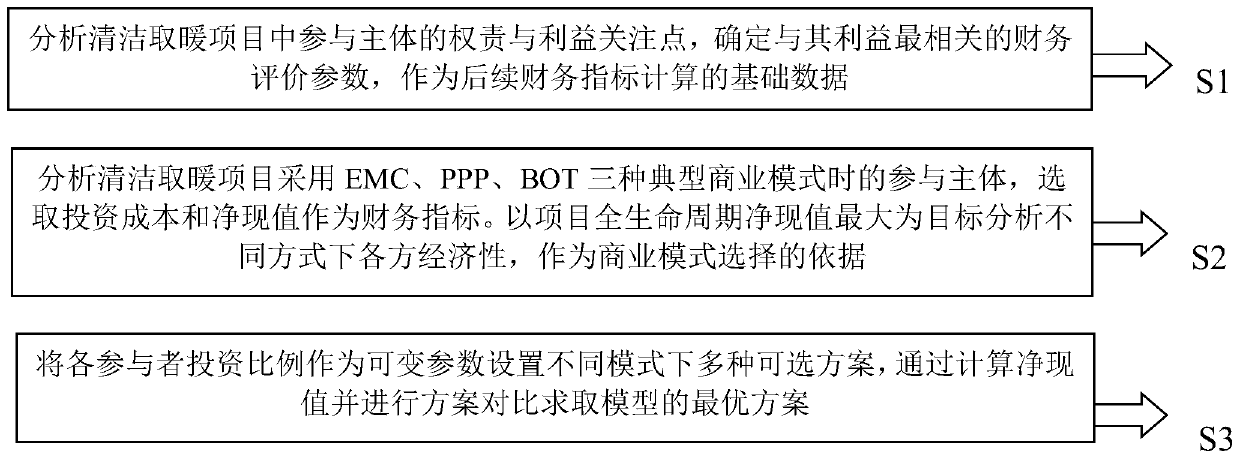

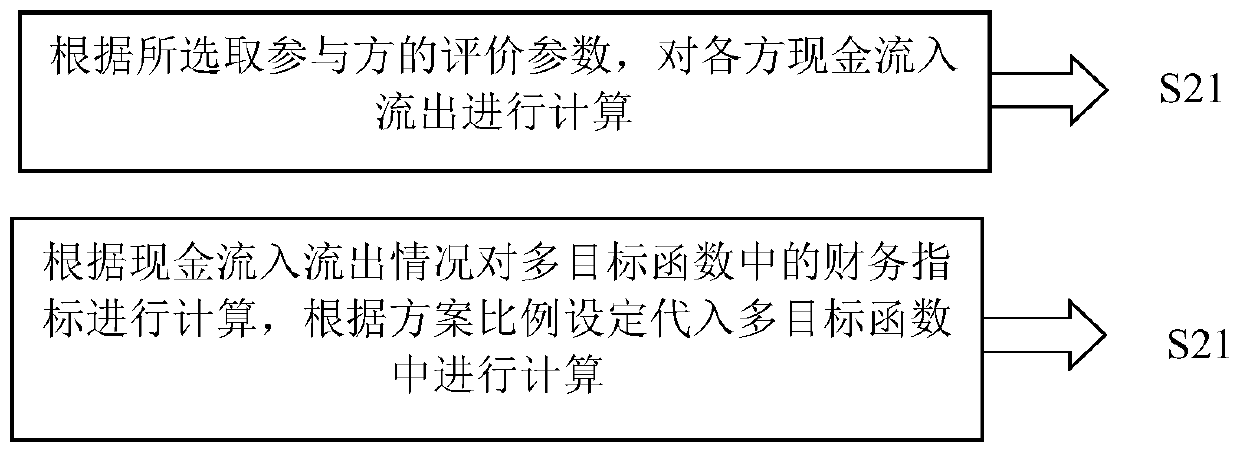

Cleaning and heating project business model feasibility and optimization analysis method and system

The invention relates to a cleaning and heating project business mode feasibility and optimization analysis method and system, and belongs to the technical field of heating. The cleaning and heating project business mode feasibility and optimization analysis method comprises the following steps: analyzing responsibility and benefit concern points participating in a subject in a clean heating project, and determining financial evaluation parameters most related to the benefit as basic data for financial index calculation; analyzing participation subjects of the clean heating projects in three modes of EMC, PPP and BOT, and selecting the investment cost and the net present value as financial indexes; taking the maximum net present value of the whole life cycle of the project as a target to analyze the economy of each party under different modes as a selection basis of a business mode; and taking the investment proportion of each participant as a variable parameter to set a plurality of optional schemes in different modes, and calculating a net present value and comparing the schemes to obtain an optimal scheme of the model. By combining the characteristics of a commercial mode, the cleaning and heating project business mode feasibility and optimization analysis method provides a preferable commercial mode, provides a scientific basis for a clean heating project by adopting a novel commercial mode, and can effectively promote the innovative work of the business mode in the clean heating project.

Owner:NORTH CHINA ELECTRICAL POWER RES INST

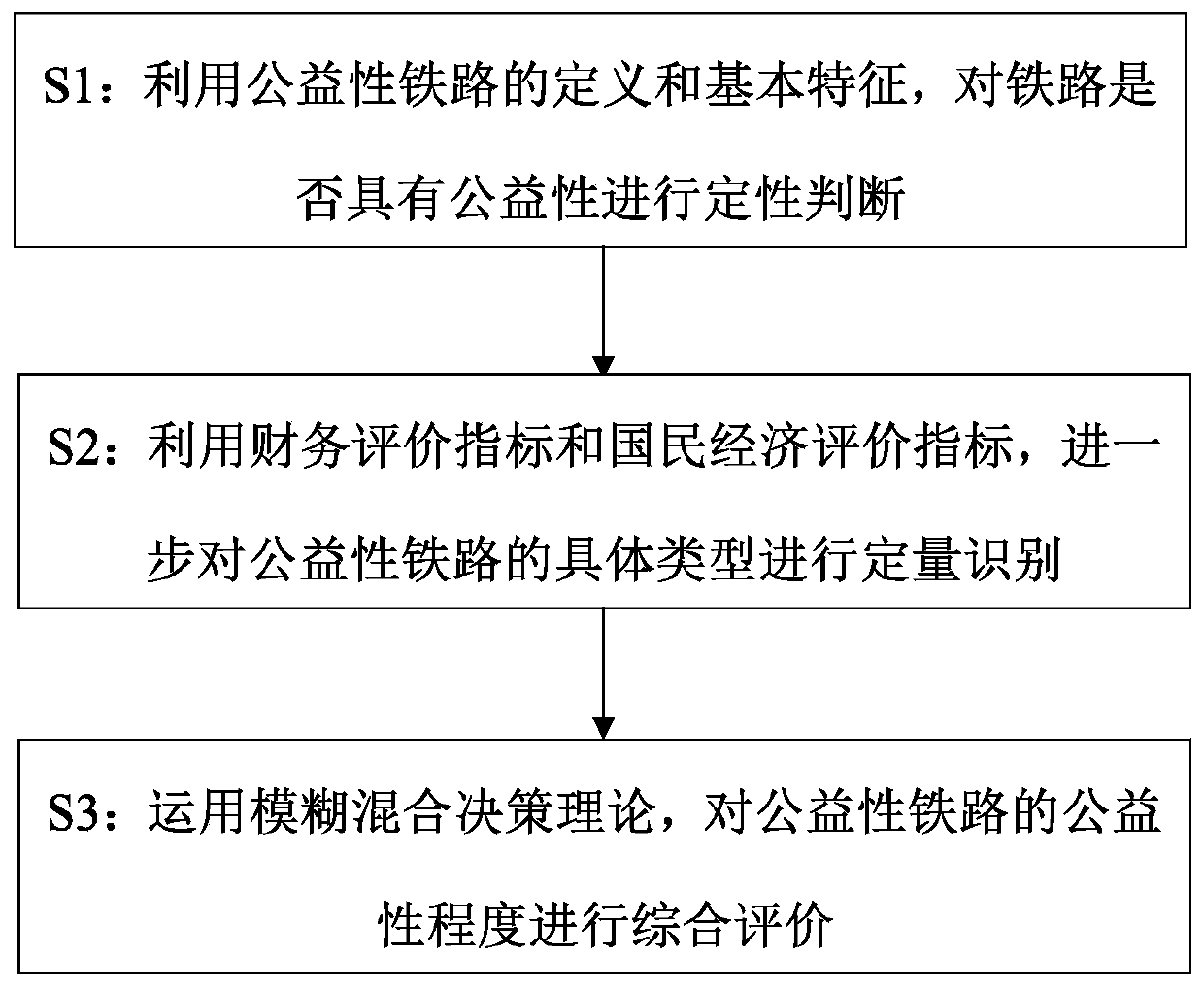

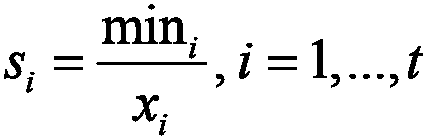

Public welfare railway judgment method

InactiveCN110111023ASolve the problem that it is difficult to quantitatively identify public welfare railwaysThe selection of indicators to solve the problem is not comprehensive enoughResourcesEngineeringDecision taking

The invention discloses a public welfare railway judgment method which comprises the following steps of S1, qualitatively judging whether a railway has the public welfare or not by utilizing the definition and the basic characteristics of a public welfare railway; S2, further quantitatively identifying the specific type of the public welfare railway by utilizing a financial evaluation index and anational economy evaluation index; and S3, comprehensively evaluating the public welfare degree of the public welfare railway by applying the fuzzy mixed decision theory. According to the invention, the definition and the basic characteristics of the public welfare railways are comprehensively considered, the financial internal return rate and the economic internal return rate in the current railway economic evaluation system are considered, and the latest theory in the international comprehensive evaluation aspect is introduced to carry out the comprehensive evaluation on the public benefit degree, so that the problems that in the prior art, the expert qualitative analysis is still adopted to judge whether a railway has public benefit or not is subjectively, and the quantitative judgmenton the public benefit railway is difficult, are effectively solved, and the blank in the field of public benefit railway research is filled up.

Owner:CHINA RAILWAY ERYUAN ENG GRP CO LTD

Enterprise financial evaluation management method, system and device based on health state and storage medium

The invention discloses an enterprise financial evaluation management method, system and device based on a health state, and a storage medium. The method comprises the following steps: setting evaluation indexes according to an operation management dimension and a risk control management dimension; editing the weight of each evaluation index according to the interactive influence relationship between the operation management and the risk control management; grading the health indexes; obtaining the score of each evaluation index of the to-be-evaluated enterprise, calculating the health index value of the to-be-evaluated enterprise according to the weight of each evaluation index, evaluating the health state of the to-be-evaluated enterprise through the divided levels, and achieving the evaluation of the financial health state of the enterprise. According to the method, the system, the equipment and the storage medium, the assessed enterprise finance can be assessed more accurately.

Owner:BEIJING SGITG ACCENTURE INFORMATION TECH CO LTD +3

Industrial enterprise performance evaluation management information system

PendingCN113393139AConducive to long-term developmentReasonable designFinanceOffice automationBusiness enterpriseProfit rate

The invention discloses an industrial enterprise performance evaluation management information system, and relates to the technical field of performance evaluation. The system comprises financial evaluation indexes and non-financial evaluation indexes; the financial evaluation indexes are used for reflecting the generated measurable economic achievements; profit is the core target of the enterprise, and the performance evaluation financial indexes are associated with the profit ability of the enterprise and comprise the three financial indexes of the main business profit rate, the total asset return rate and the economic added value; and the non-financial evaluation indexes comprise evaluation of an enterprise operation process, evaluation of enterprise stakeholders, and evaluation of enterprise research and development capability and innovation capability. The system is reasonable in design, the competitiveness of an industrial enterprise can be effectively improved, and great development of the industrial enterprise is guaranteed.

Owner:南通楚恒科技有限公司

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com