Patents

Literature

Hiro is an intelligent assistant for R&D personnel, combined with Patent DNA, to facilitate innovative research.

167 results about "Electronic communication network" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

An electronic communication network (ECN) is a type of computerized forum or network that facilitates the trading of financial products outside traditional stock exchanges. An ECN is generally an electronic system that widely disseminates orders entered by market makers to third parties and permits the orders to be executed against in whole or in part. The primary products that are traded on ECNs are stocks and currencies. ECNs are generally passive computer-driven networks that internally match limit orders and charge a very small per share transaction fee (often a fraction of a cent per share).

Product value information interchange server

InactiveUS7133834B1Improve recognitionImprove market shareMarket predictionsClient-sideService information

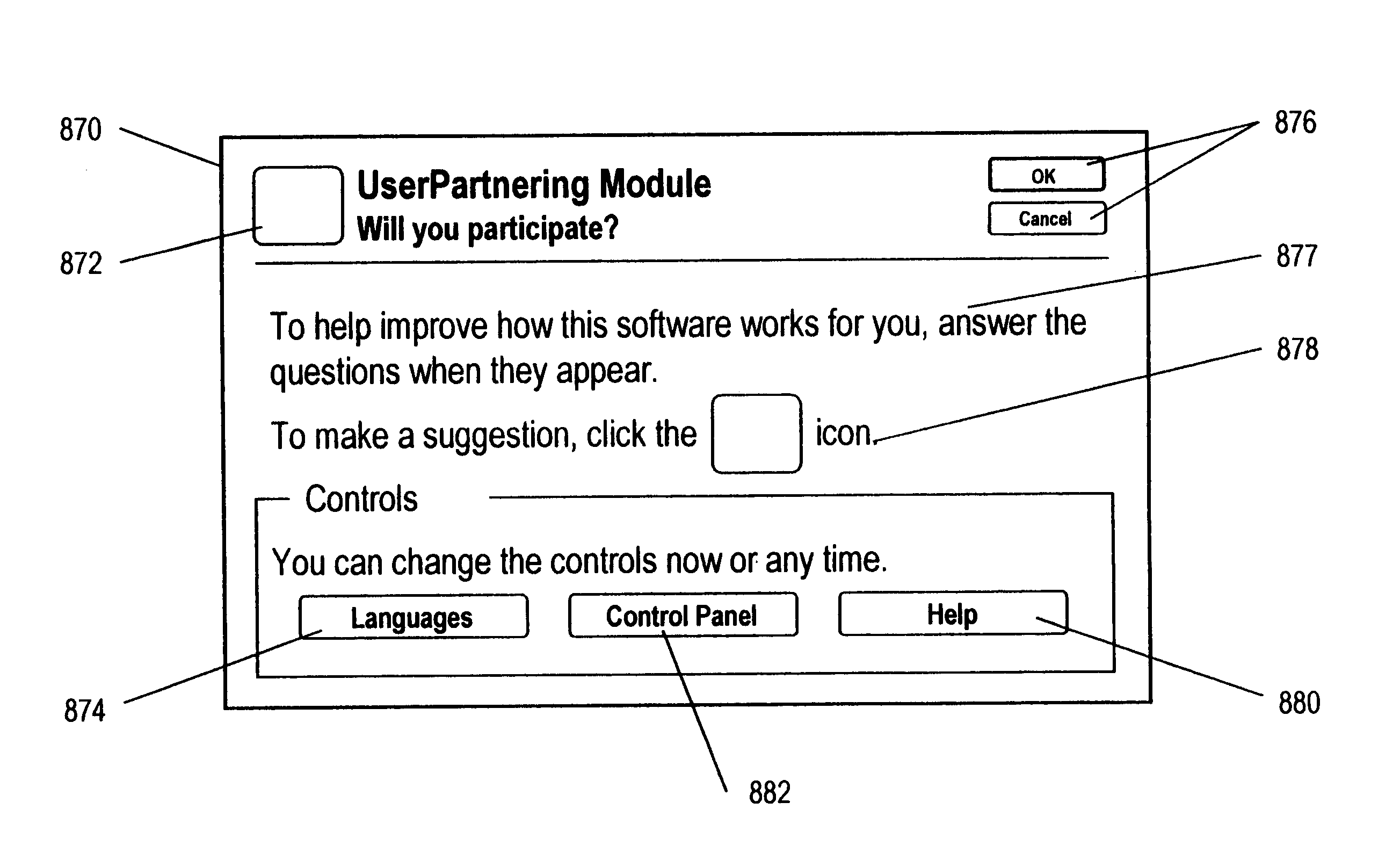

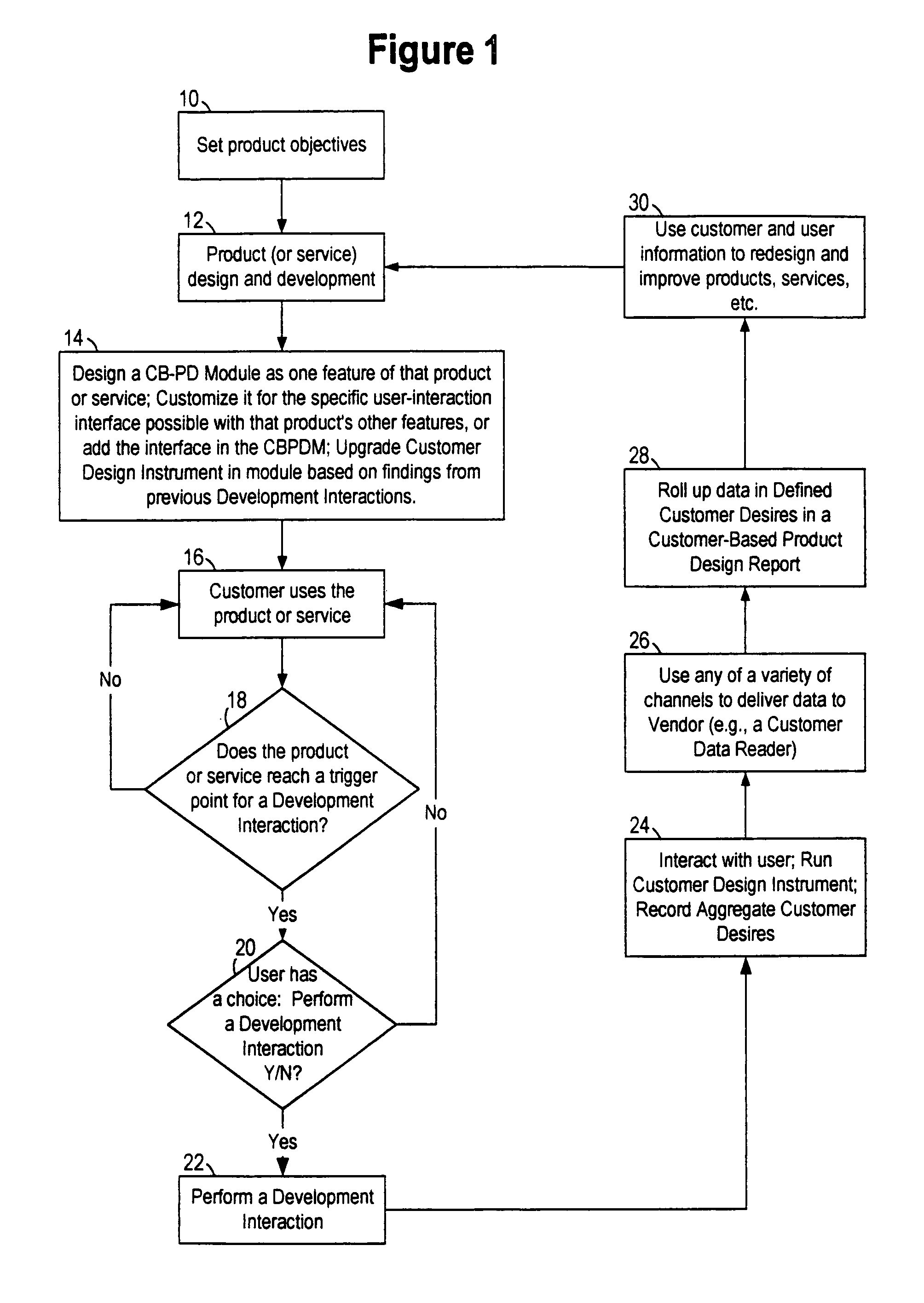

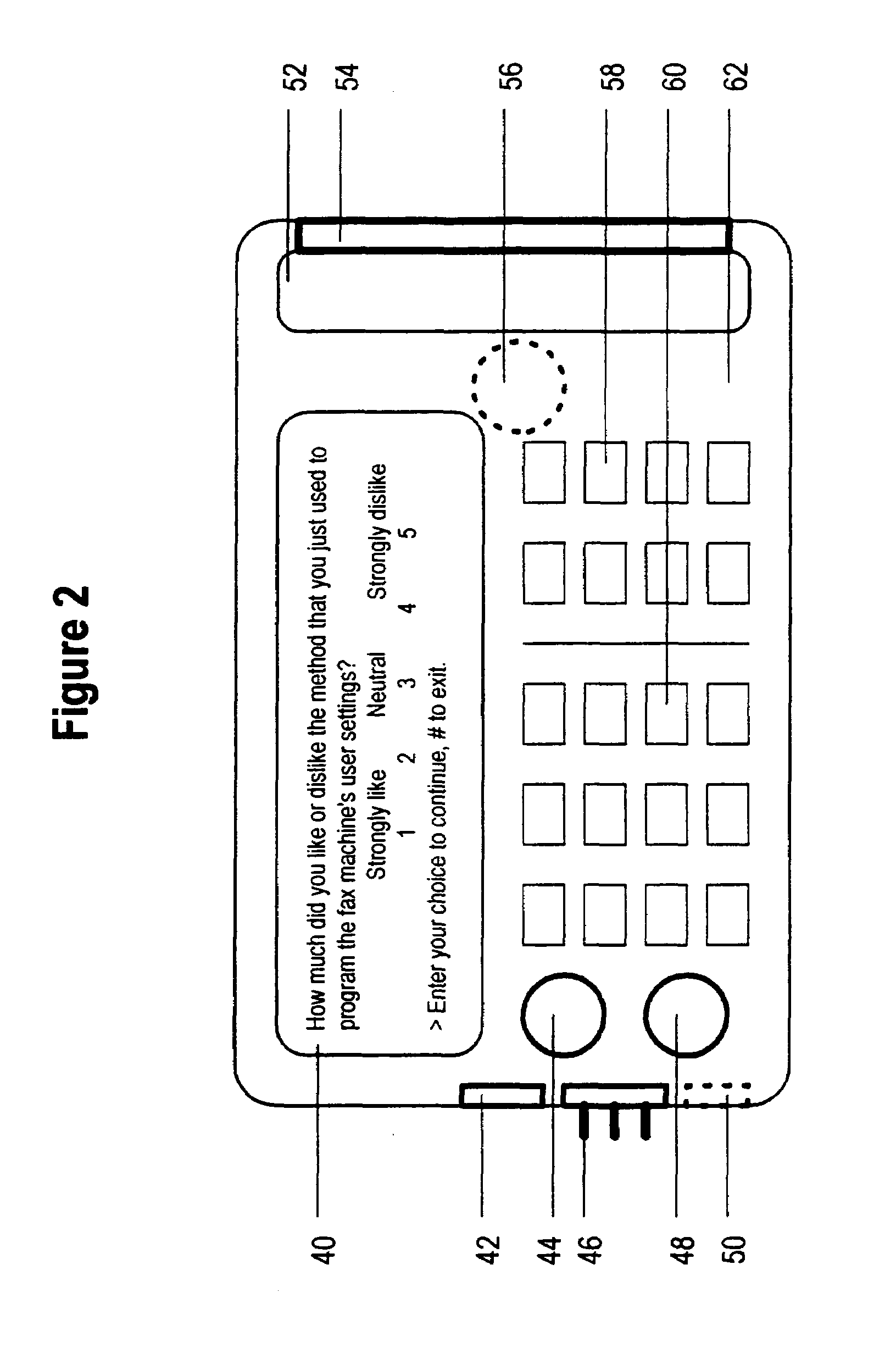

An electronically accessible server receives, stores, and sends value information from customers. The server or other digital medium stores the value information generated by independent users. Triggers or interactions can be used to determine when value information would be useful for a user of a client system. The value information can include customer assessments, usage frequency, navigational pointers, executable program code, instructions, product information, and service information. A digital medium is used to store value information generated by independent users. The medium can be coupled to an electronic communication network to allow for interchange of information.

Owner:LODSYS GRP

Systems and methods for automated audio transcription, translation, and transfer

InactiveUS7035804B2Improve accuracyShort timeNatural language translationSpeech recognitionElectronic communication networkSpeech sound

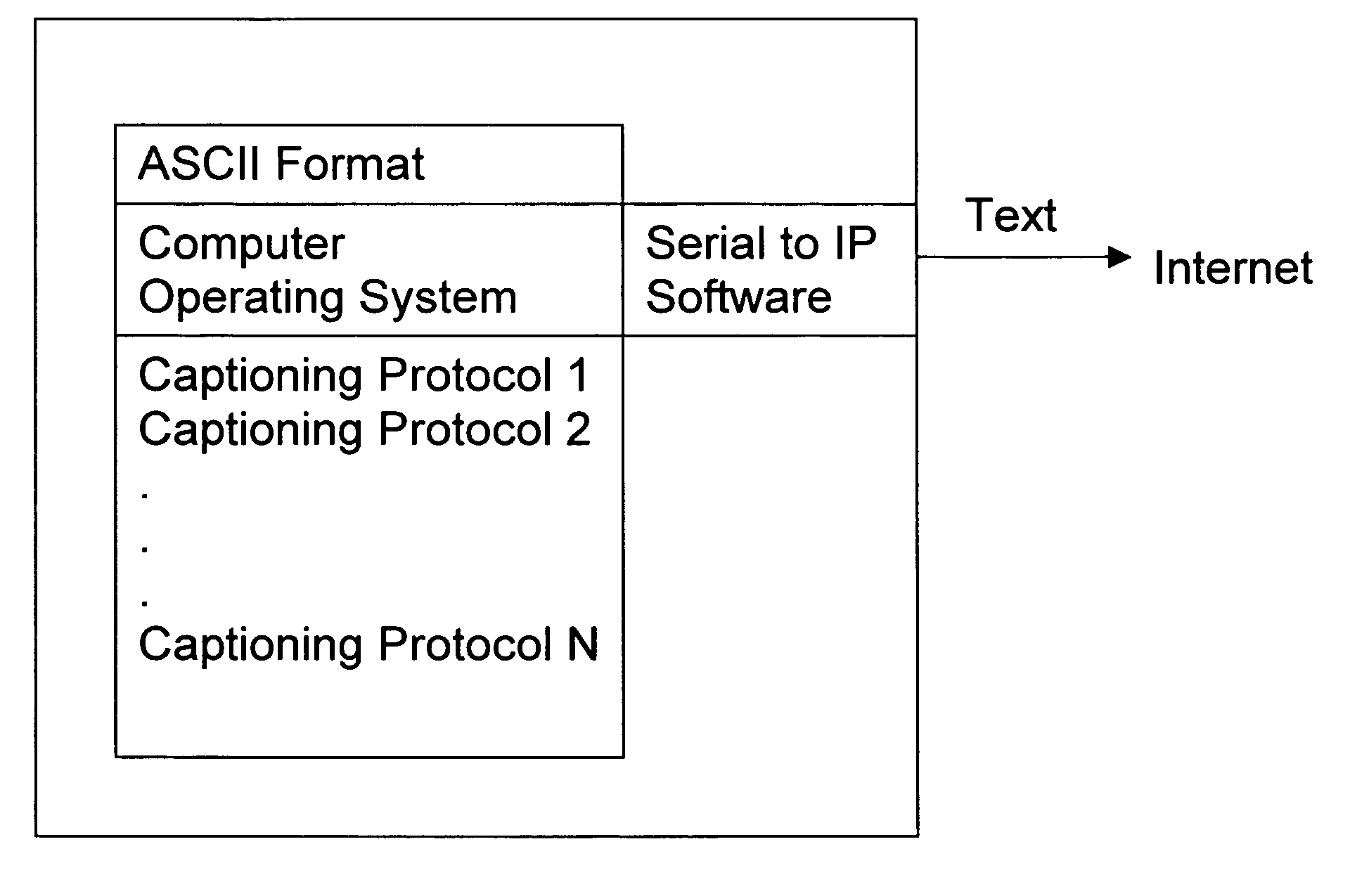

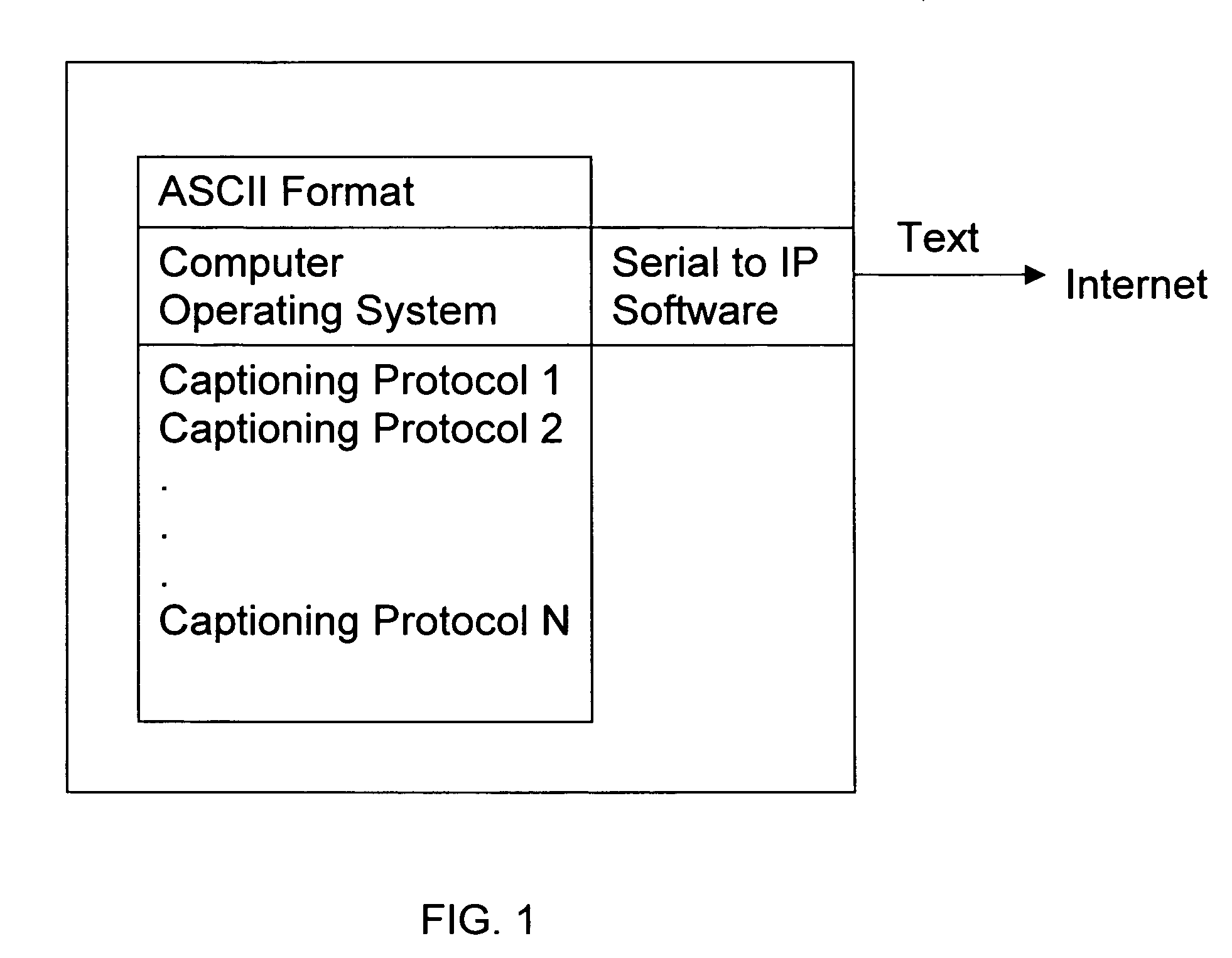

The present invention relates to systems and methods for audio processing. For example, the present invention provides systems and methods for creating standardized text for streaming text application from a variety of different speech-to-text software formats and systems and methods for interfacing a stenographic computer with an electronic communications network.

Owner:COURTROOM CONNECT

Method of constructing and displaying an entity profile constructed utilizing input from entities other than the owner

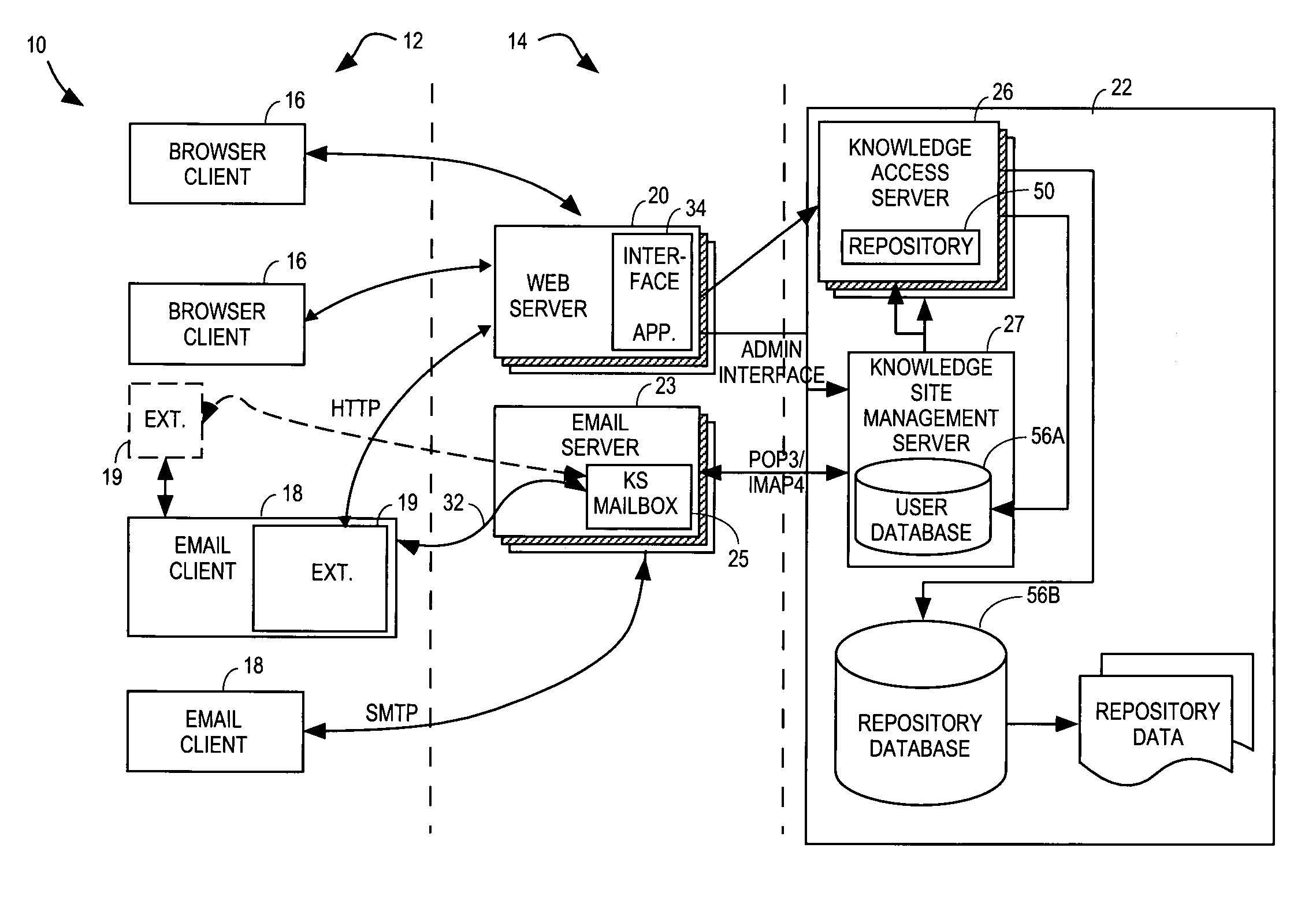

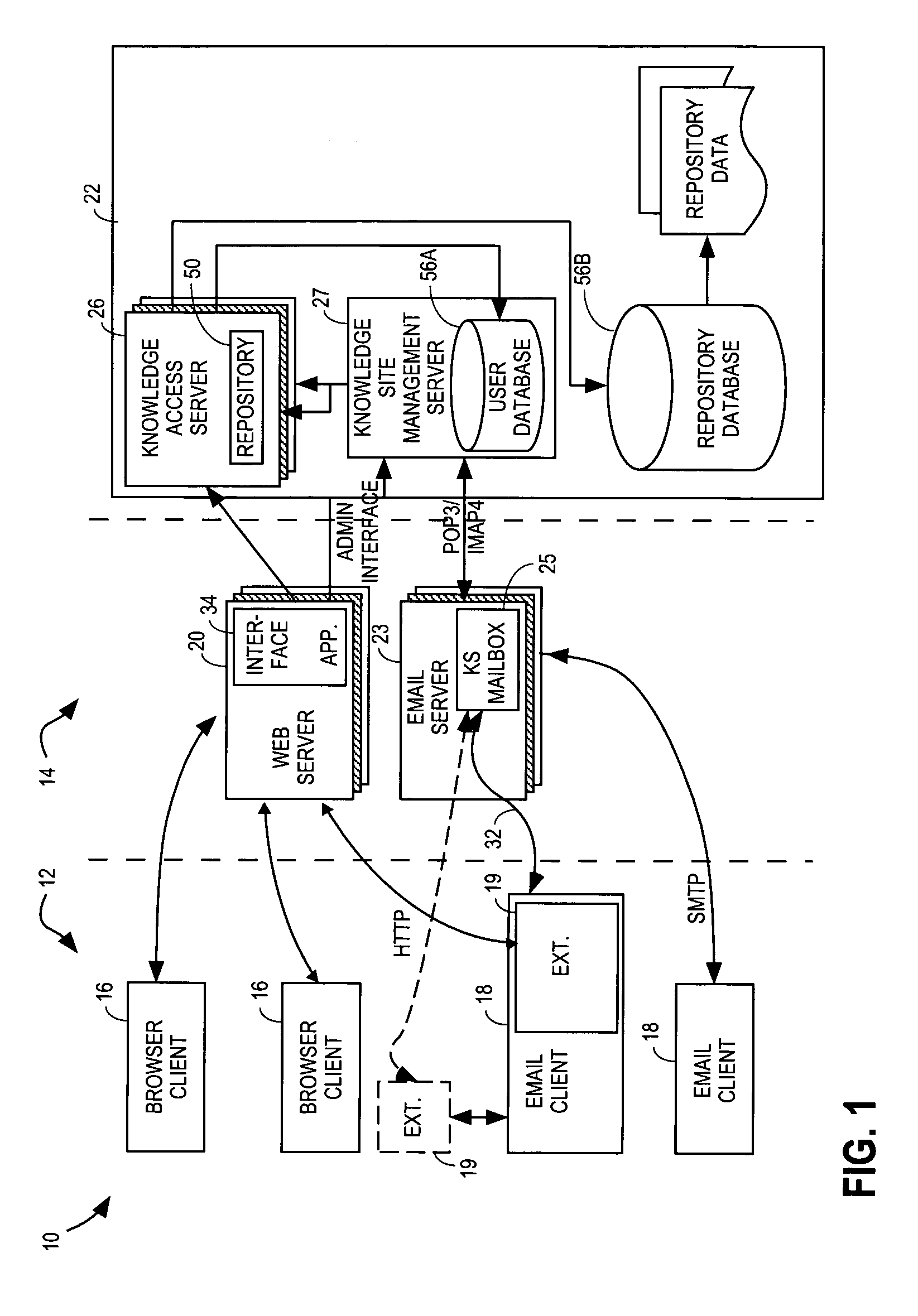

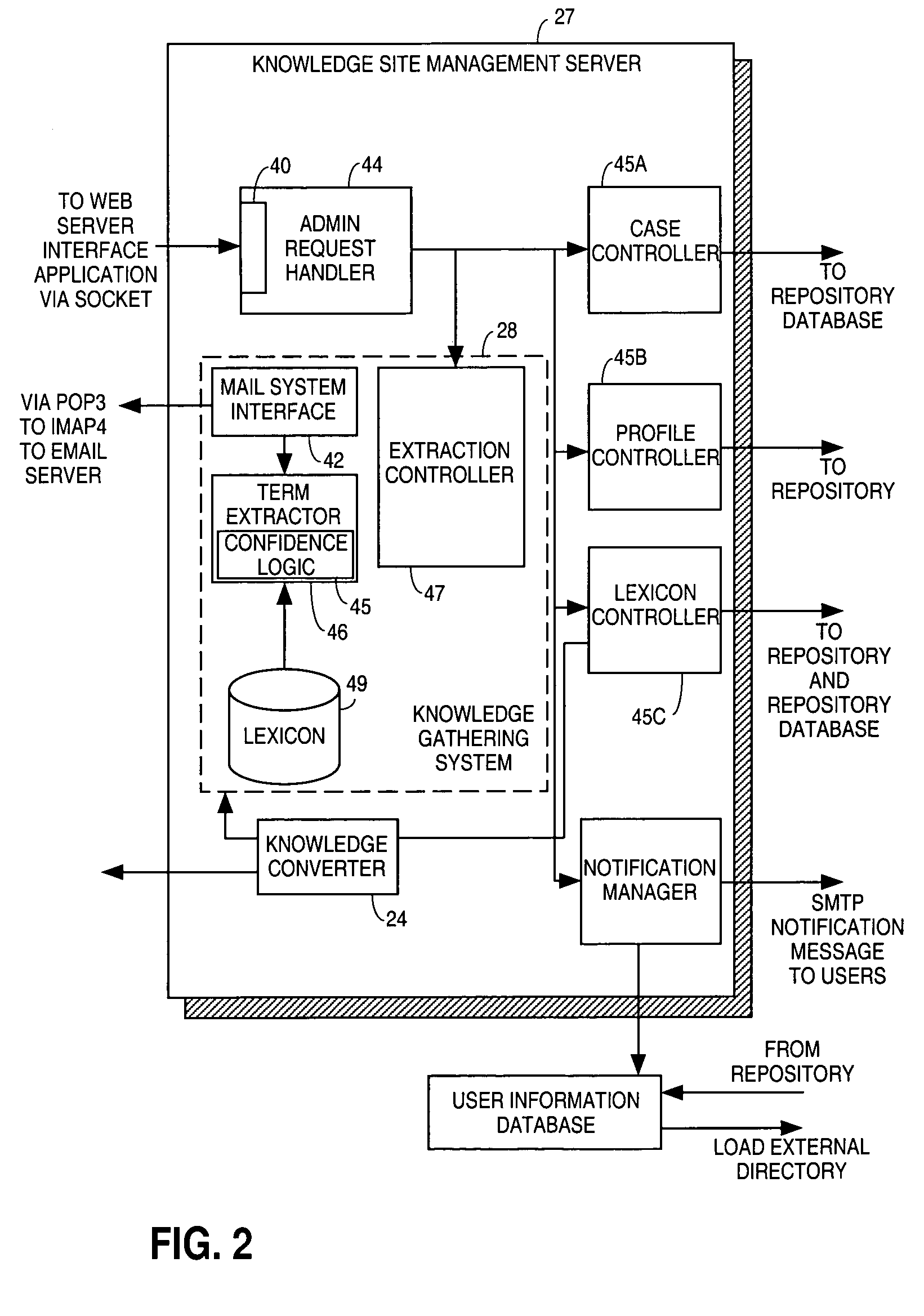

A method of constructing a profile comprising terms indicative of a characteristic of an entity commences when first electronic mail address, associated with a first entity, is created within a knowledge management system. The electronic mail address may be created automatically upon submission of an electronic mail document, or may be created manually by a systems administrator. A first electronic document is received via an electronic communications network at the first electronic mail address from a second entity, typically a user of the knowledge management system who is a registered and interactive user. The first electronic document is then parsed to identify profile terms therein. These profile terms are included within a first profile for the first entity. In this way, users of a knowledge management system may construct a profile of an entity (e.g., a customer) that is not a user of or participant within the knowledge management system.

Owner:ORACLE INT CORP

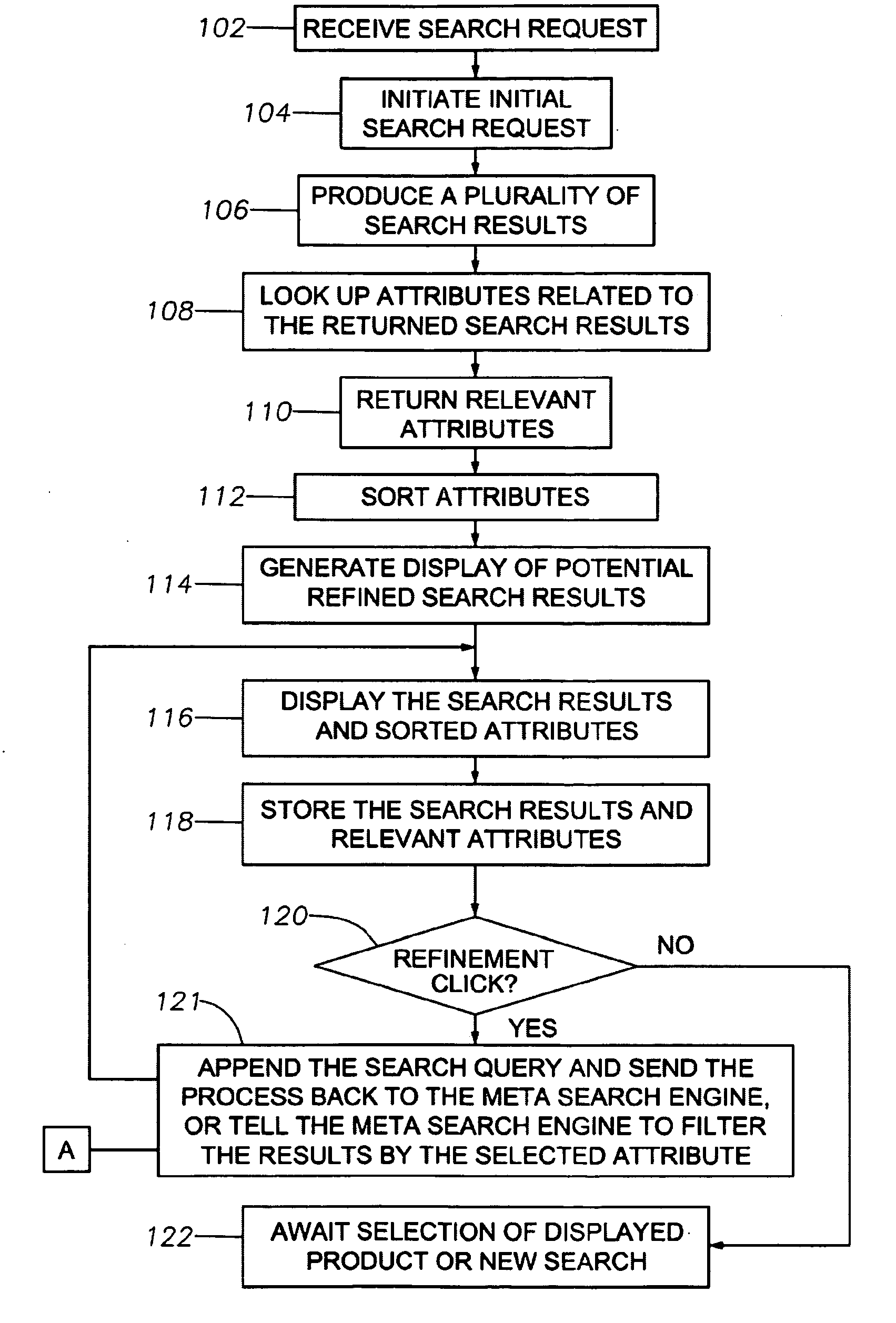

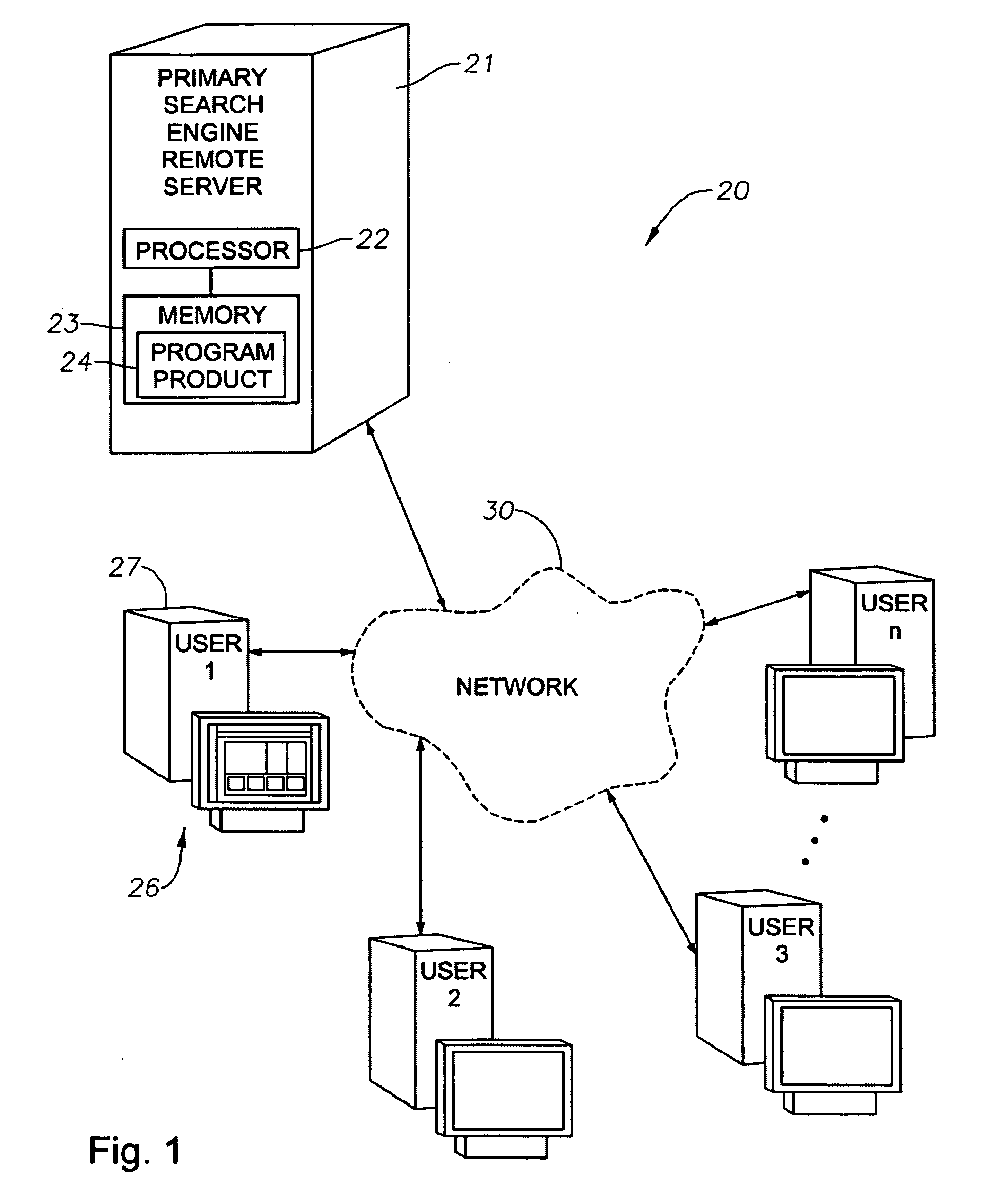

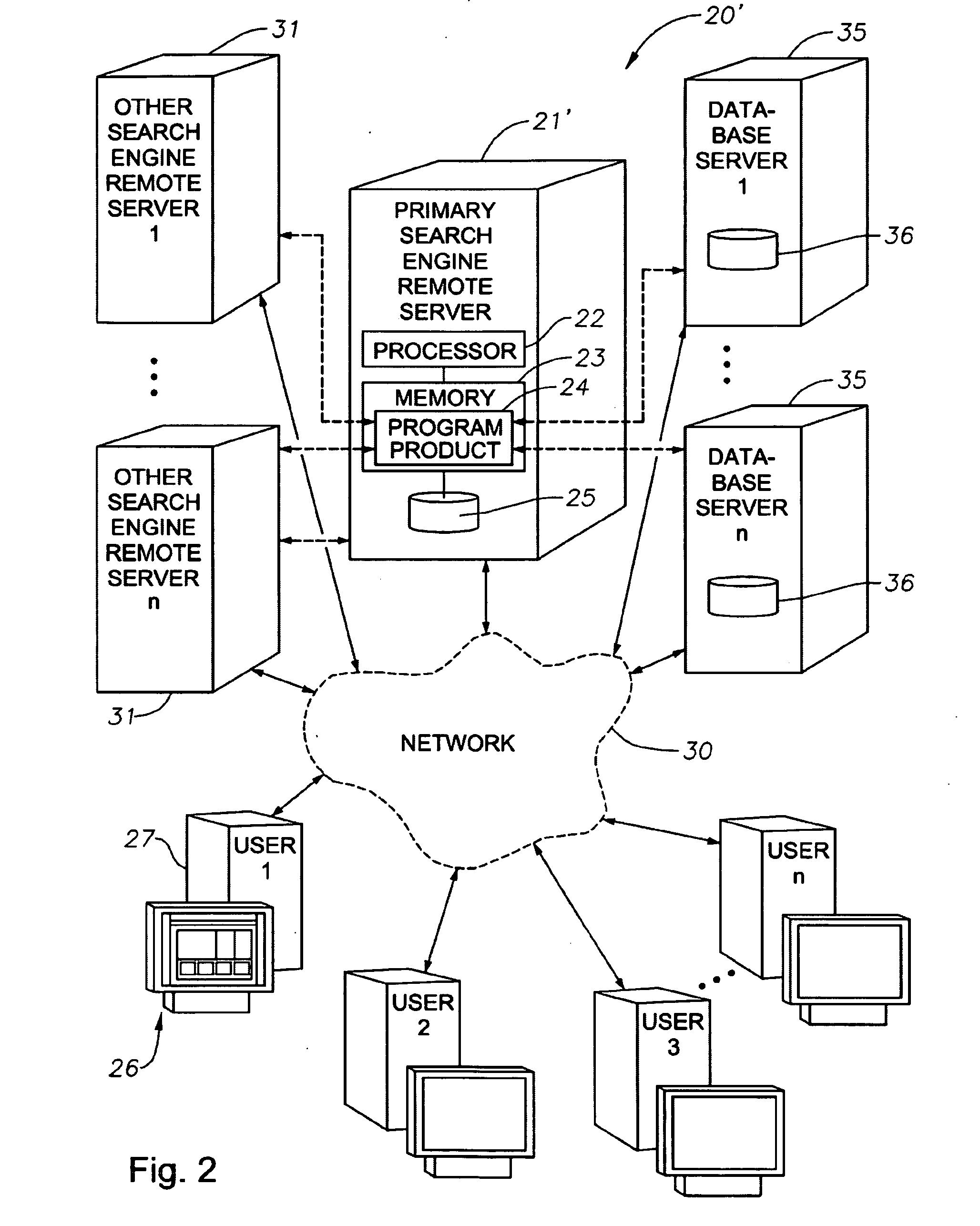

System, program product, and method of electronic communication network guided navigation

ActiveUS20090171813A1The result is moreQuickly start lookingDigital data information retrievalDigital data processing detailsWeb navigationRelevant information

Systems, program product, and methods of electronic communication network guided navigation which allow users to obtain more relevant product search results much more quickly, are provided. An example of a system can allow a user to enter or start a product search request for a relatively broad term in a search engine and quickly start looking for relevant information by assisting the user in narrowing the product search results in a more efficient guided search. The results can be displayed to a user in a row of boxes, which focus the user on categories of potential intentions or meanings behind the product search request term or terms so that the user's intent can be quickly ascertained and the user directed to results more closely aligned with or coinciding with the user's intent behind the product search request.

Owner:OVERSTOCK COM

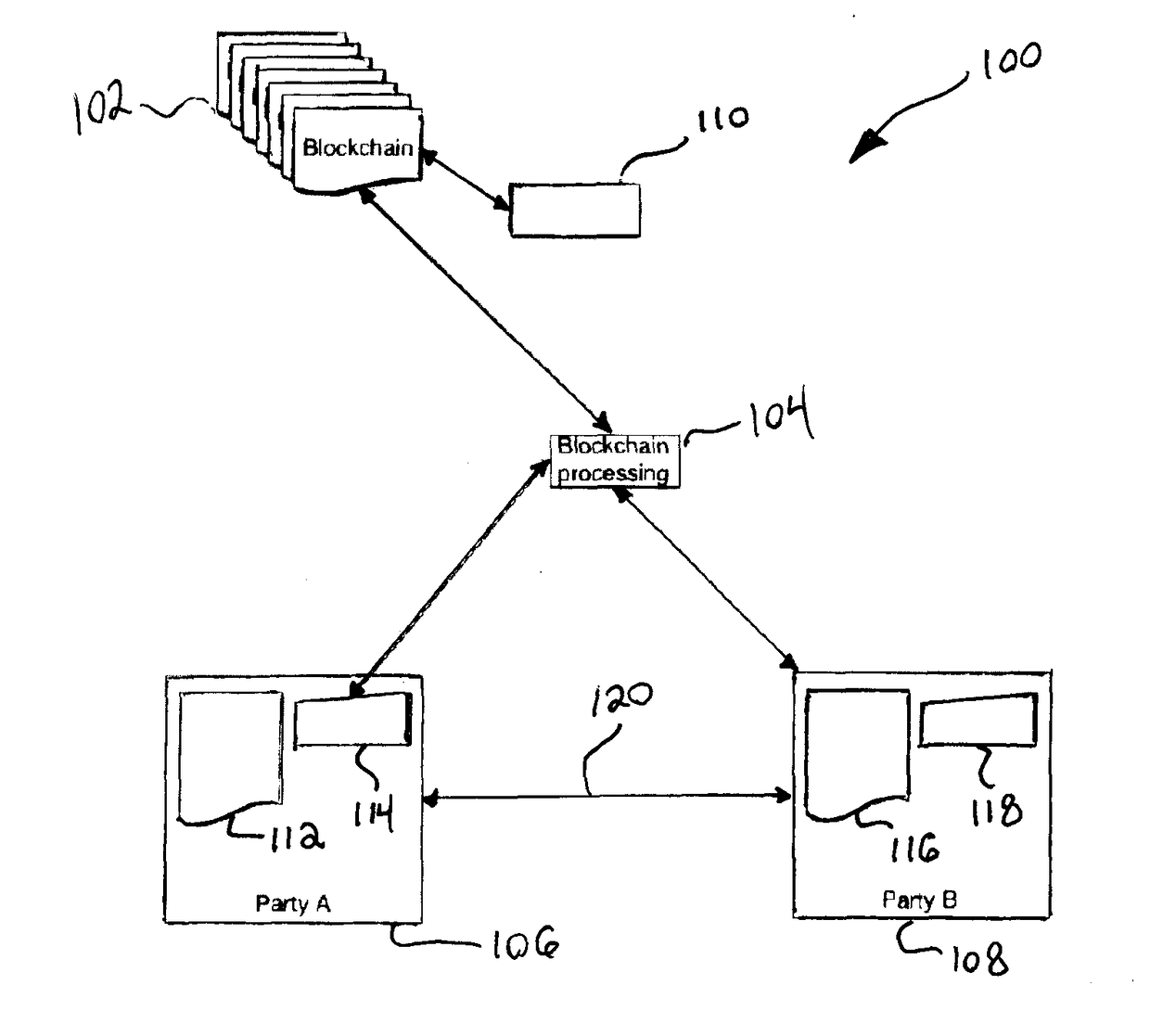

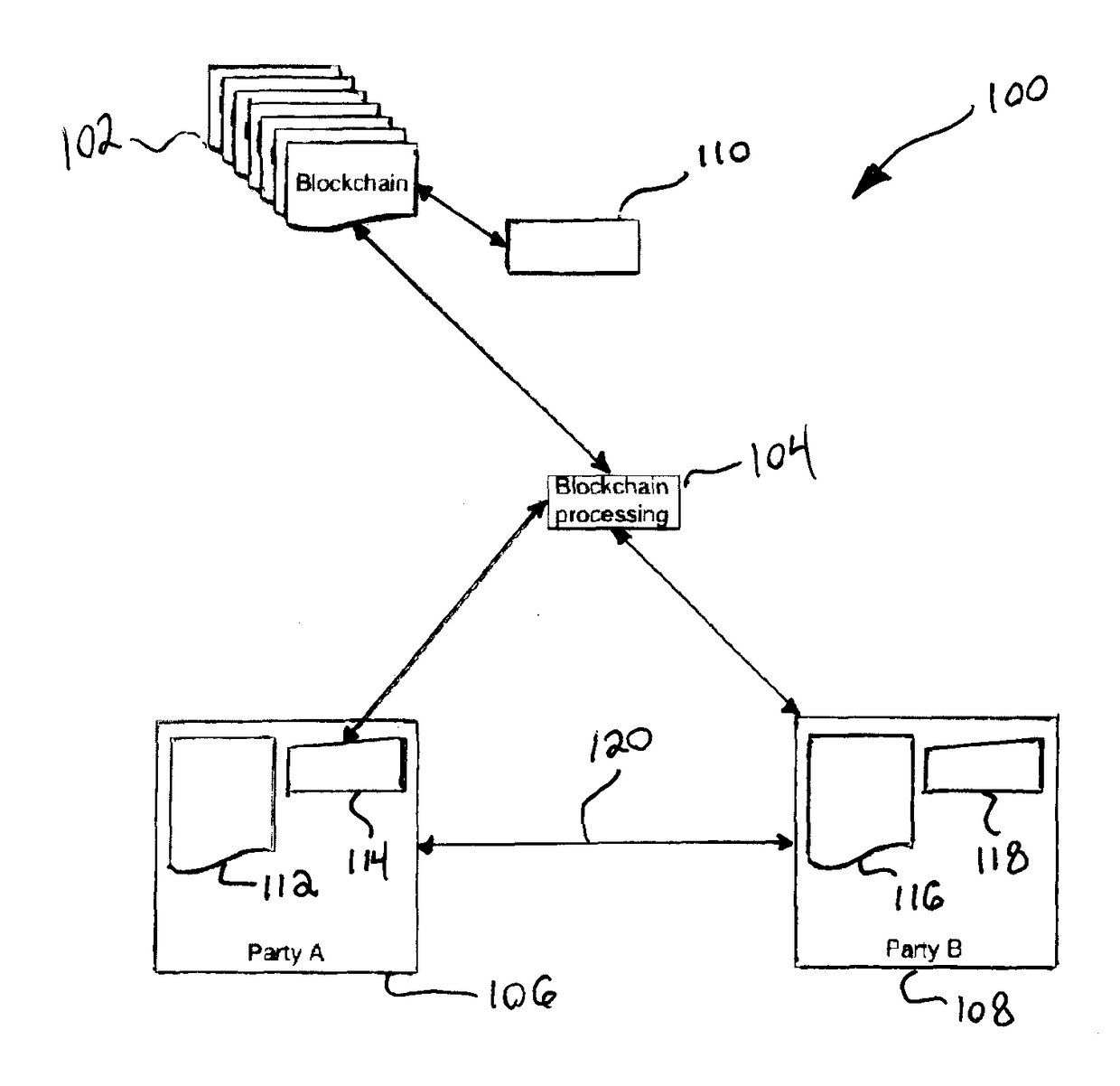

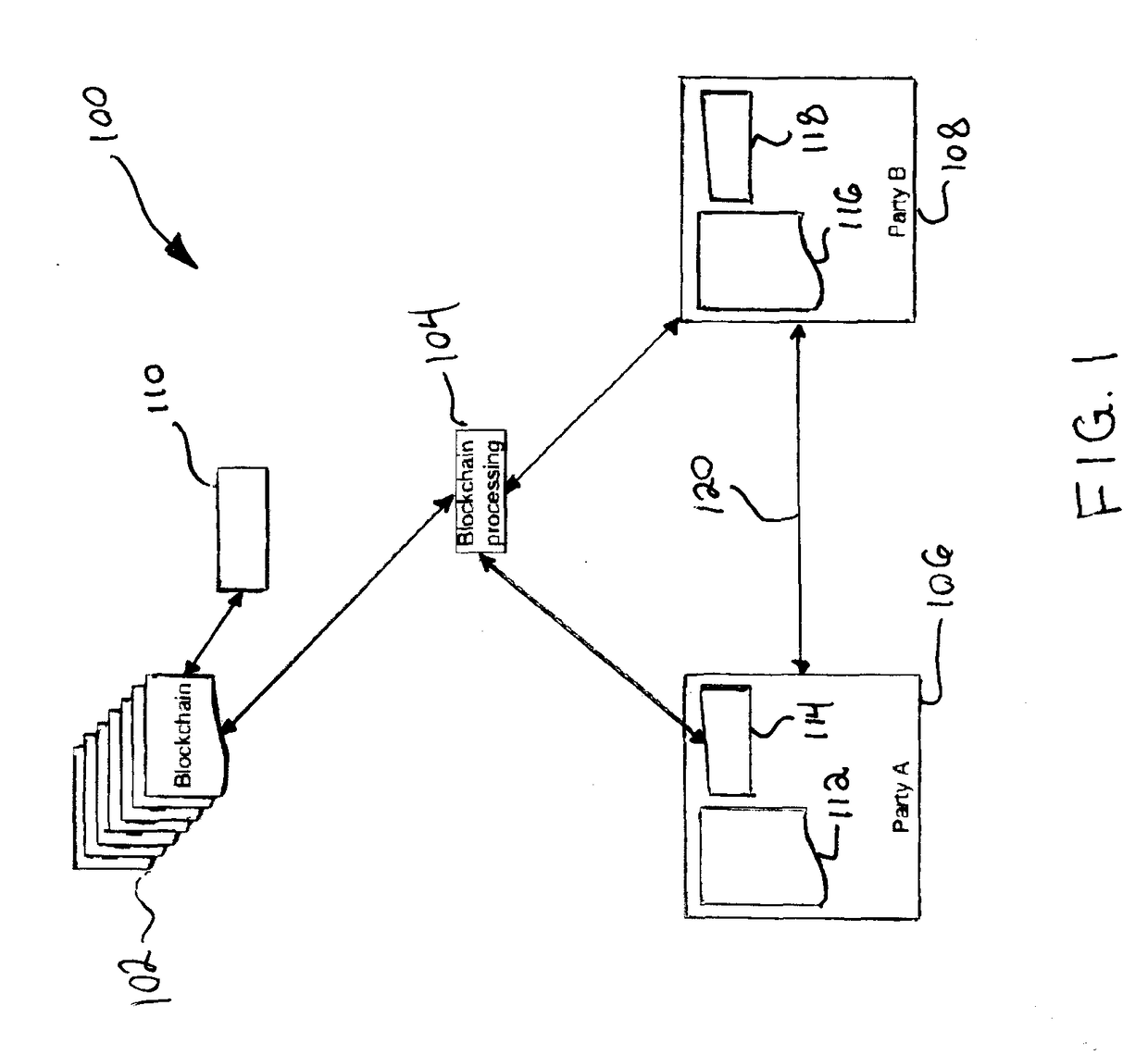

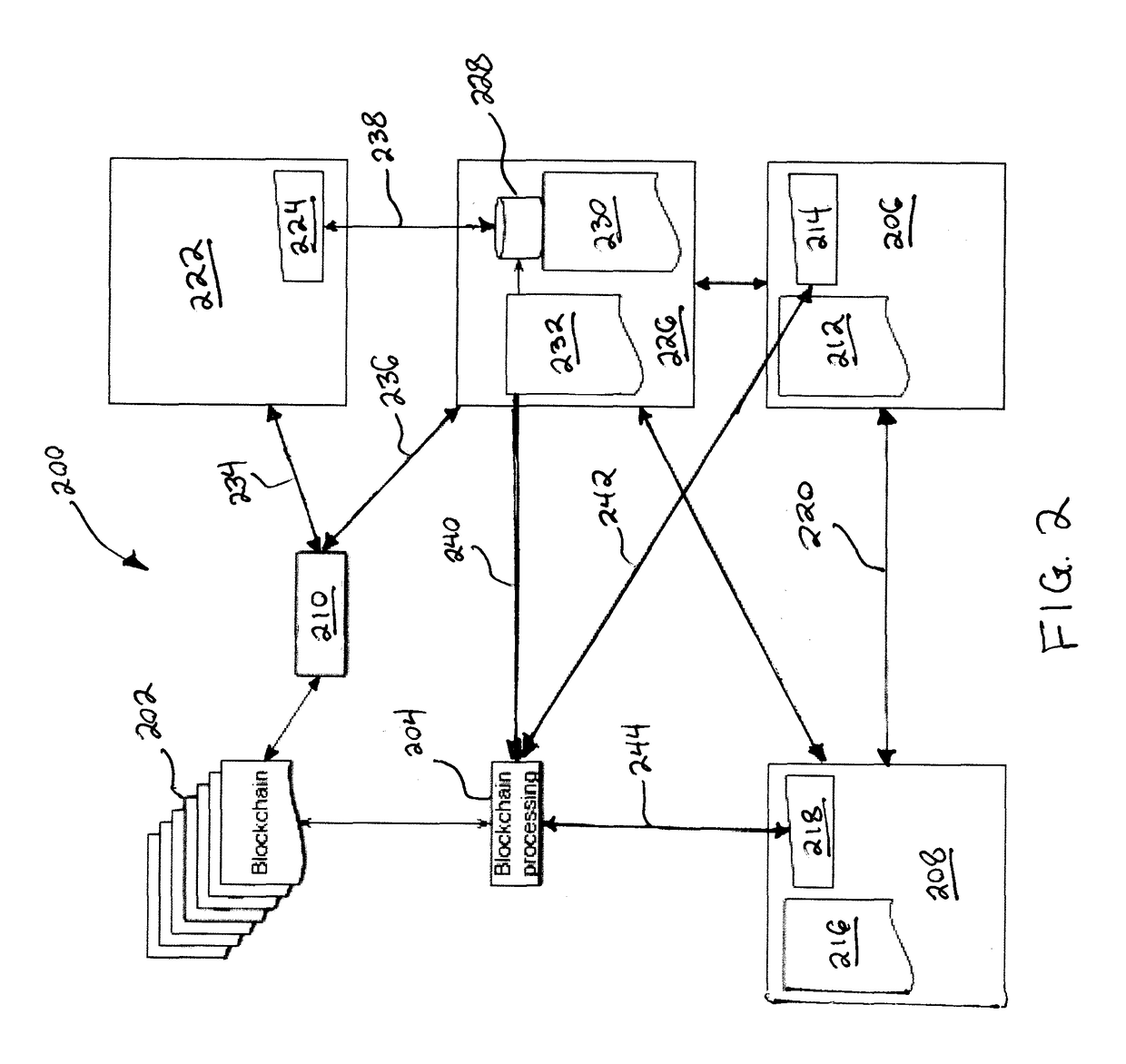

Blockchaining for media distribution

PendingUS20170134161A1Multiple keys/algorithms usageEncryption apparatus with shift registers/memoriesComputer hardwareElectronic communication network

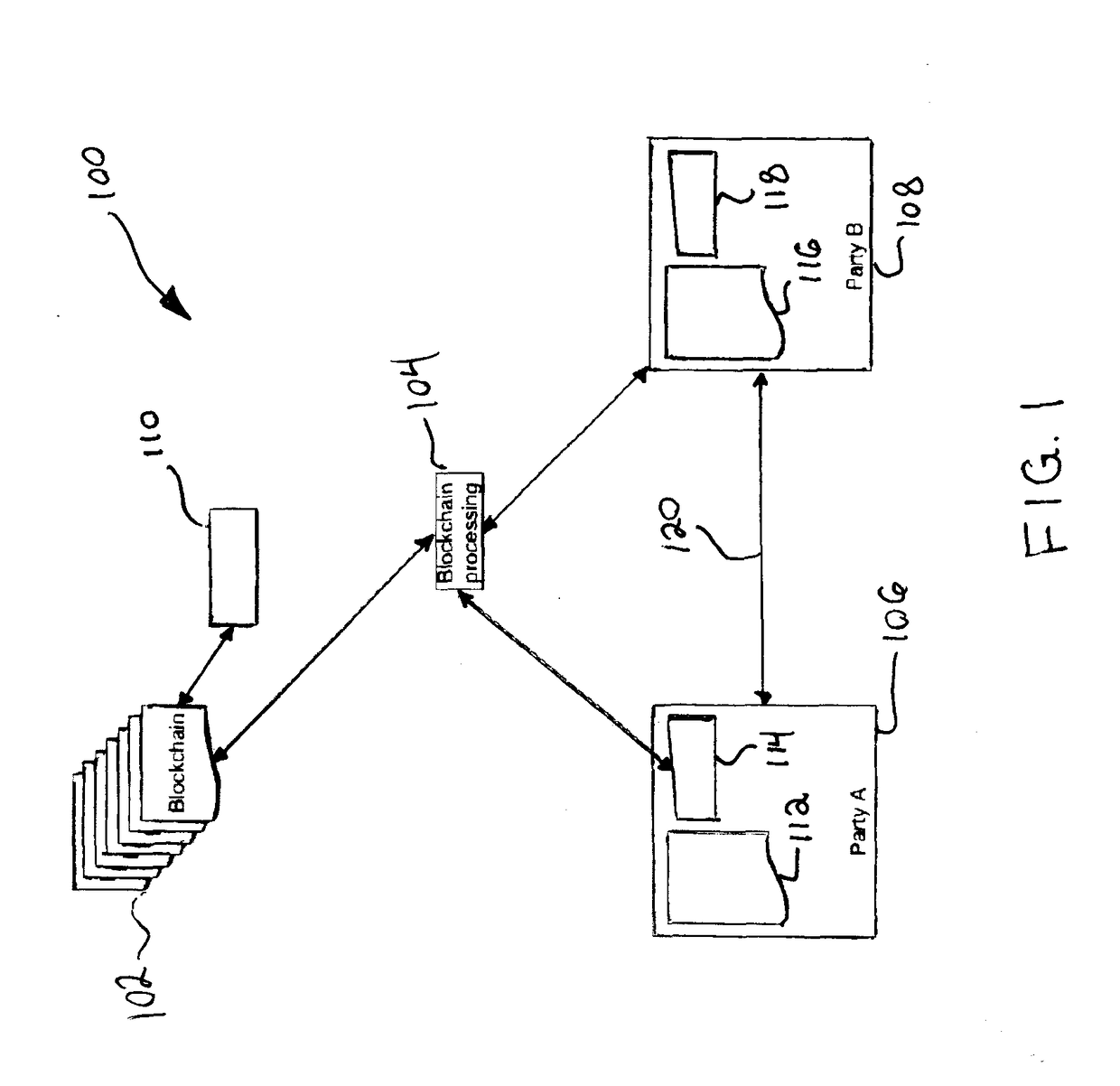

A system for distributing content over an electronic communications network includes a first electronic device including a first processor and a first memory, and a second electronic device including a second processor and a second memory. The second electronic device is configured to communicate with the first electronic device over the electronic communications network. The system further includes a blockchain and a blockchain processor in operable communication with each of the first electronic device and the second electronic device over the electronic communications network. The blockchain processor is configured to verify a transfer of content between the first electronic device and the second electronic device, and to update the blockchain with information regarding the verified transfer of content.

Owner:CABLE TELEVISION LAB

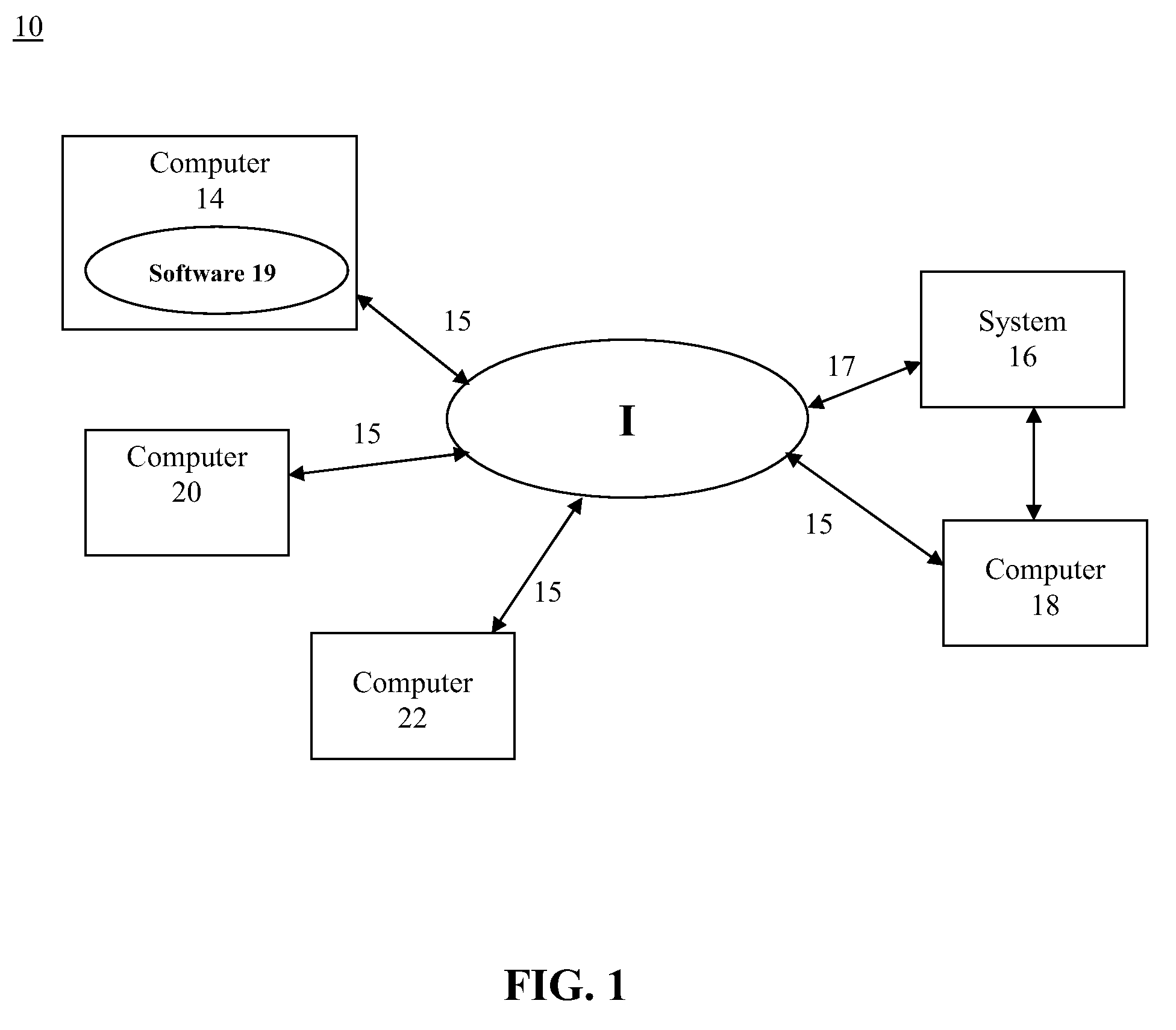

Computer based system for directing communications over electronic networks

InactiveUS7124167B1Maximal functionalityEffective meanSpecial service for subscribersData switching by path configurationGraphicsGraphical user interface

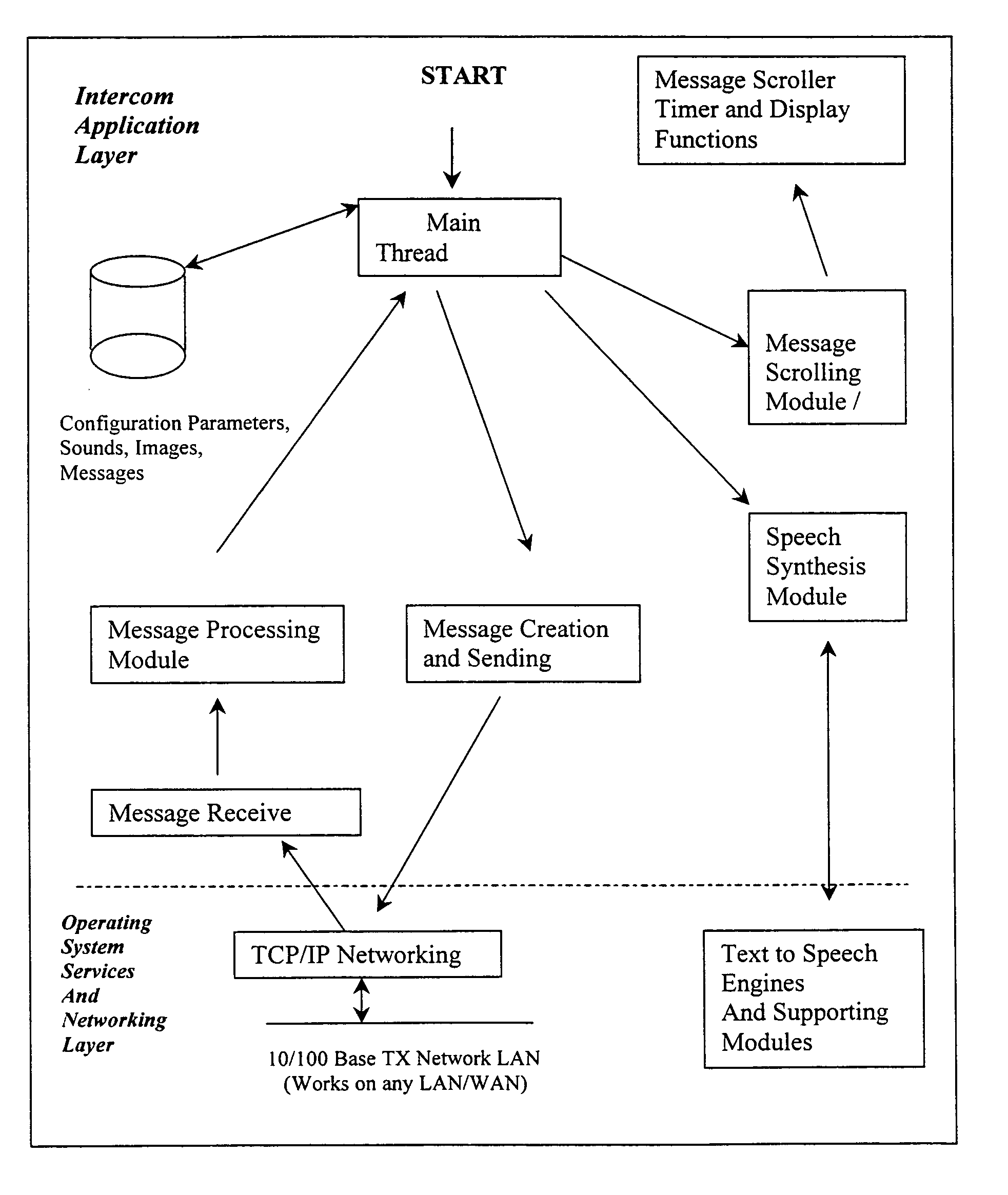

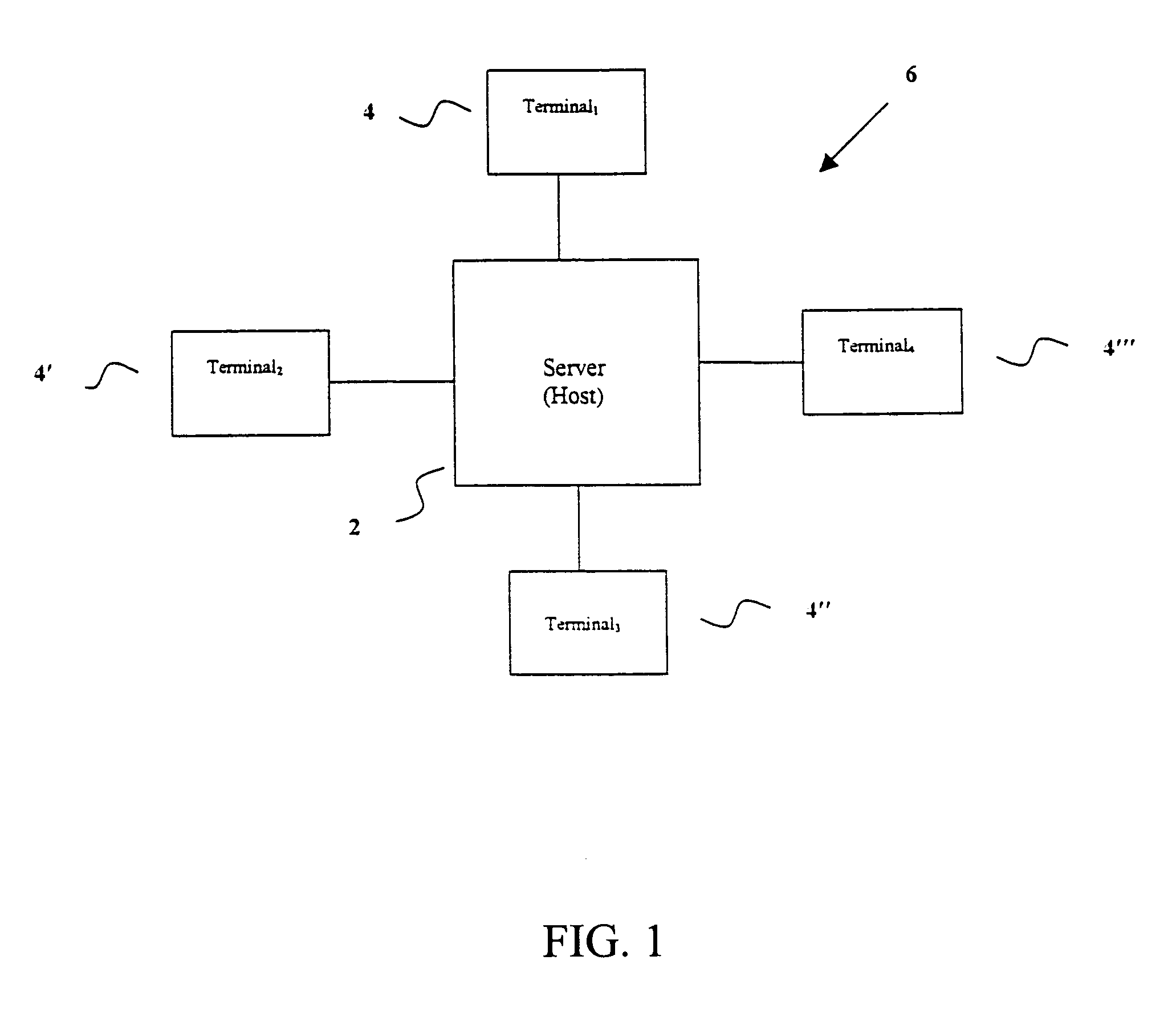

The present invention includes a system and method for communicating across an electronic communication network. The present invention permits a user of the electronic communication network to communicate with one or more other users of the electronic communication network. The software employed in such a system and method permits a user to select one or more individuals to whom communication is desired and / or one or more terminals to which communication is desired, enter a message, and send the message. The recipient or recipients of the message are defined on the network and are selectable at the sender's terminal through a graphical user interface (GUI).

Owner:BELLOTTI ALBERTO +1

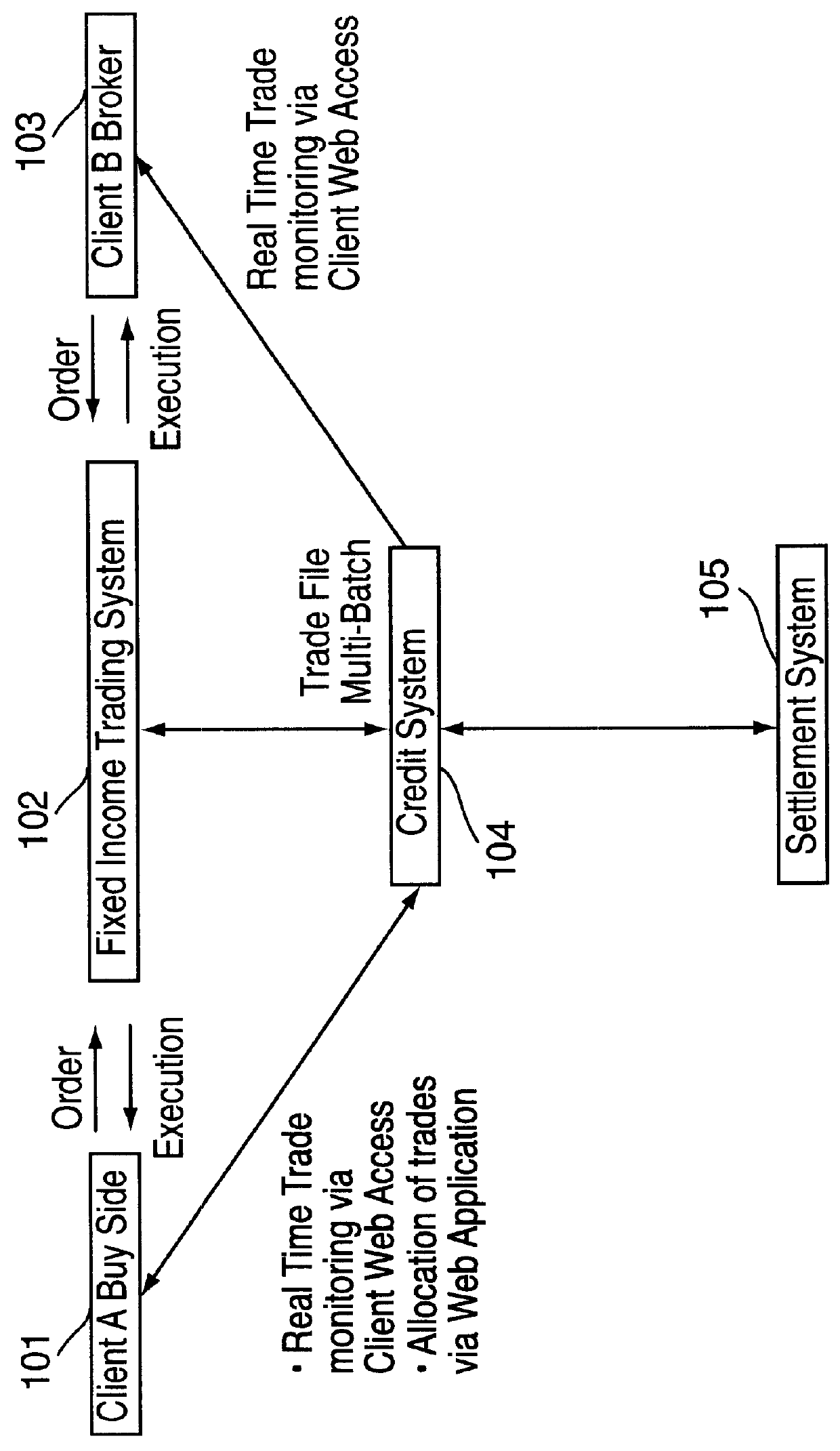

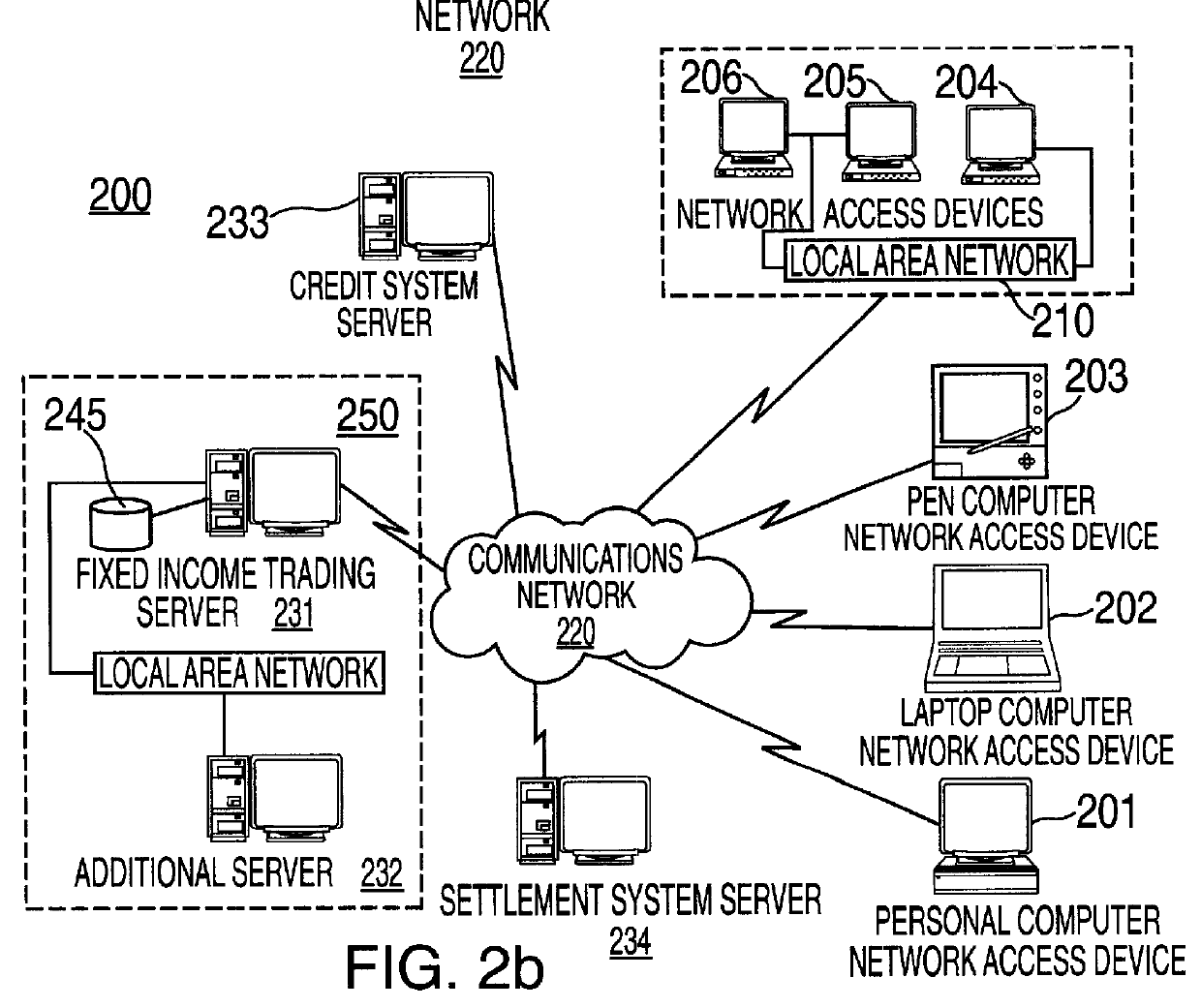

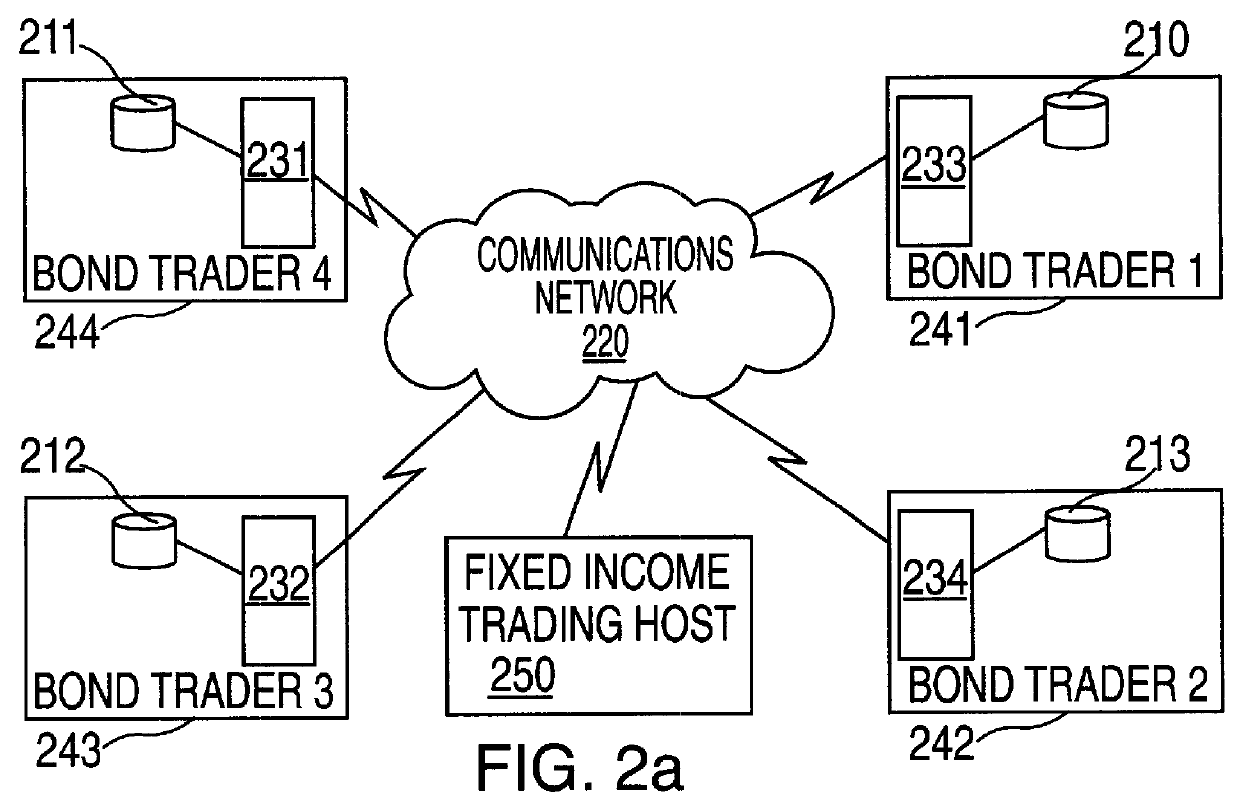

Automated fixed income trading

InactiveUSH2064H1Facilitate fixed income security trading activityFacilitate fixed income security trading activitiesFinanceSpecial data processing applicationsCombined useComputerized system

A method and system is provided for automated trading of fixed income securities which enables institutional investors, broker dealers and others, to transact directly and anonymously for the purpose of trading investment grade, high yield corporate bonds, municipal bonds or other fixed income securities. A financial institution acting as a Fixed Income Securities system sponsor can act as counterparty to transactions, from trade execution through settlement, and can also serve as a credit intermediary. Computer systems are utilized in conjunction with an electronic communications network to facilitate such fixed income security trading activities. Software routines can direct a trader to various fixed income securities available according to specific criteria put forth by the trader. Software routines can also provide information and services related to the automated trading of fixed income securities. Data relating to trading a fixed income security is transmitted from a Fixed Income Trading (FIT) system and information relating to the sale of a fixed income security is received. A live order, based upon the sale information received, can then be executed or transmitted to a point of execution. The live order provides that the FIT system acts as counterparty to each transaction such that a client trader can remain anonymous to a party on the other side of a trade. In this manner, a first trade can be executed between a party selling a fixed income security and the FIT system, and a second trade can be executed between the FIT system and a party purchasing the fixed income security. In addition, the FIT system operators can commit to market liquidity for the fixed income security traded. Numerous types of fixed income securities can be traded, including investment grade, high yield corporate bonds, municipal bonds or other types of securities.

Owner:GOLDMAN SACHS & CO LLC

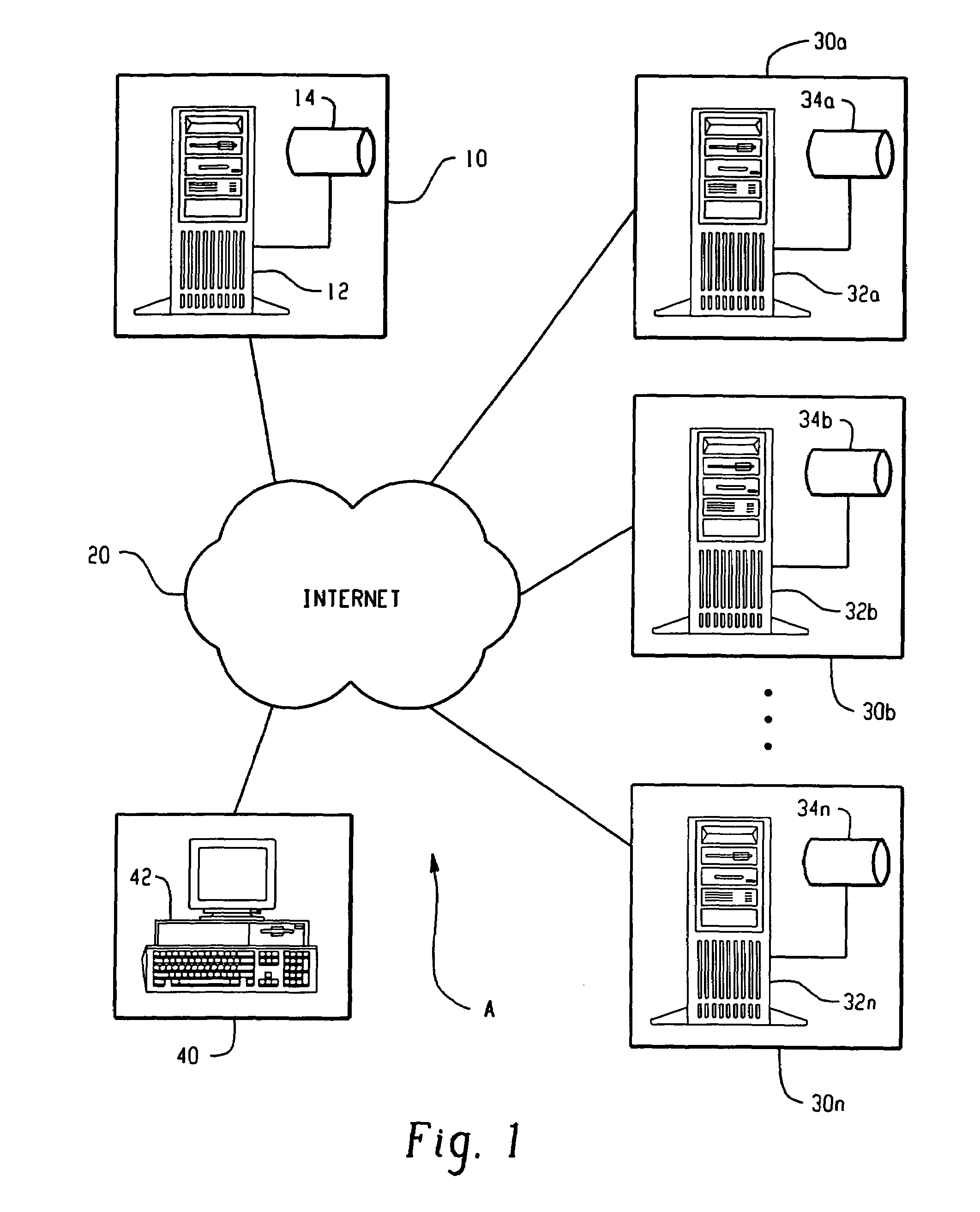

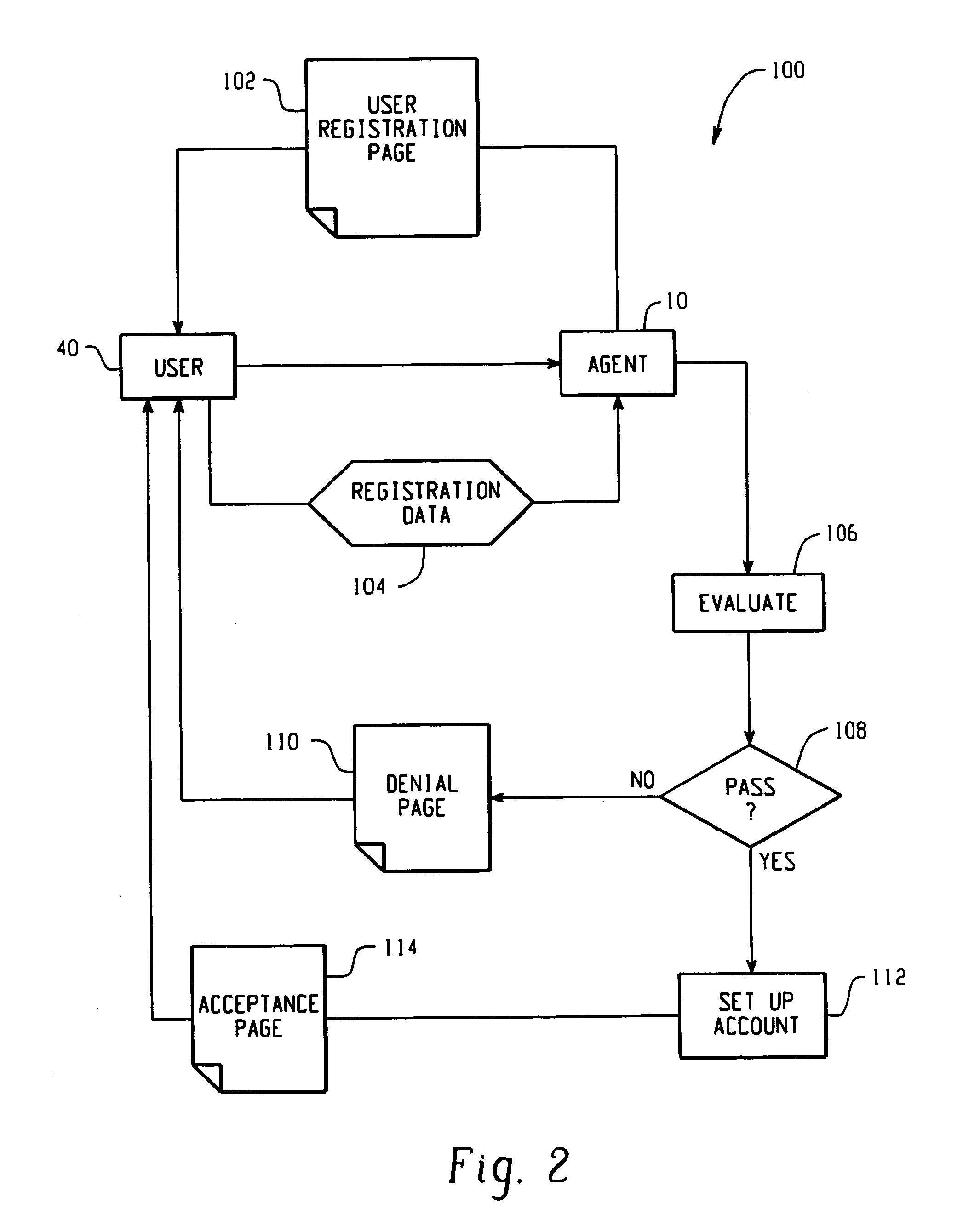

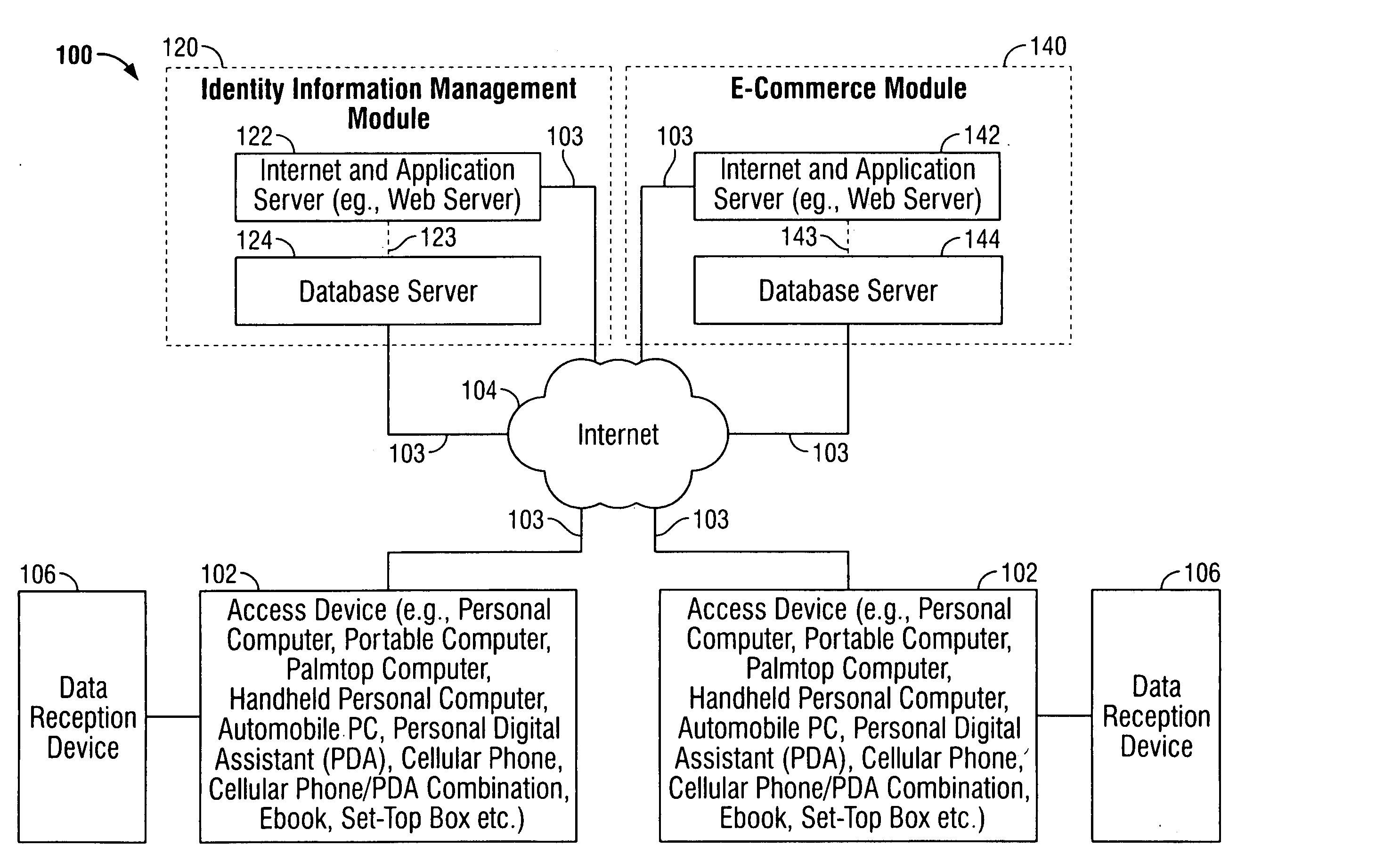

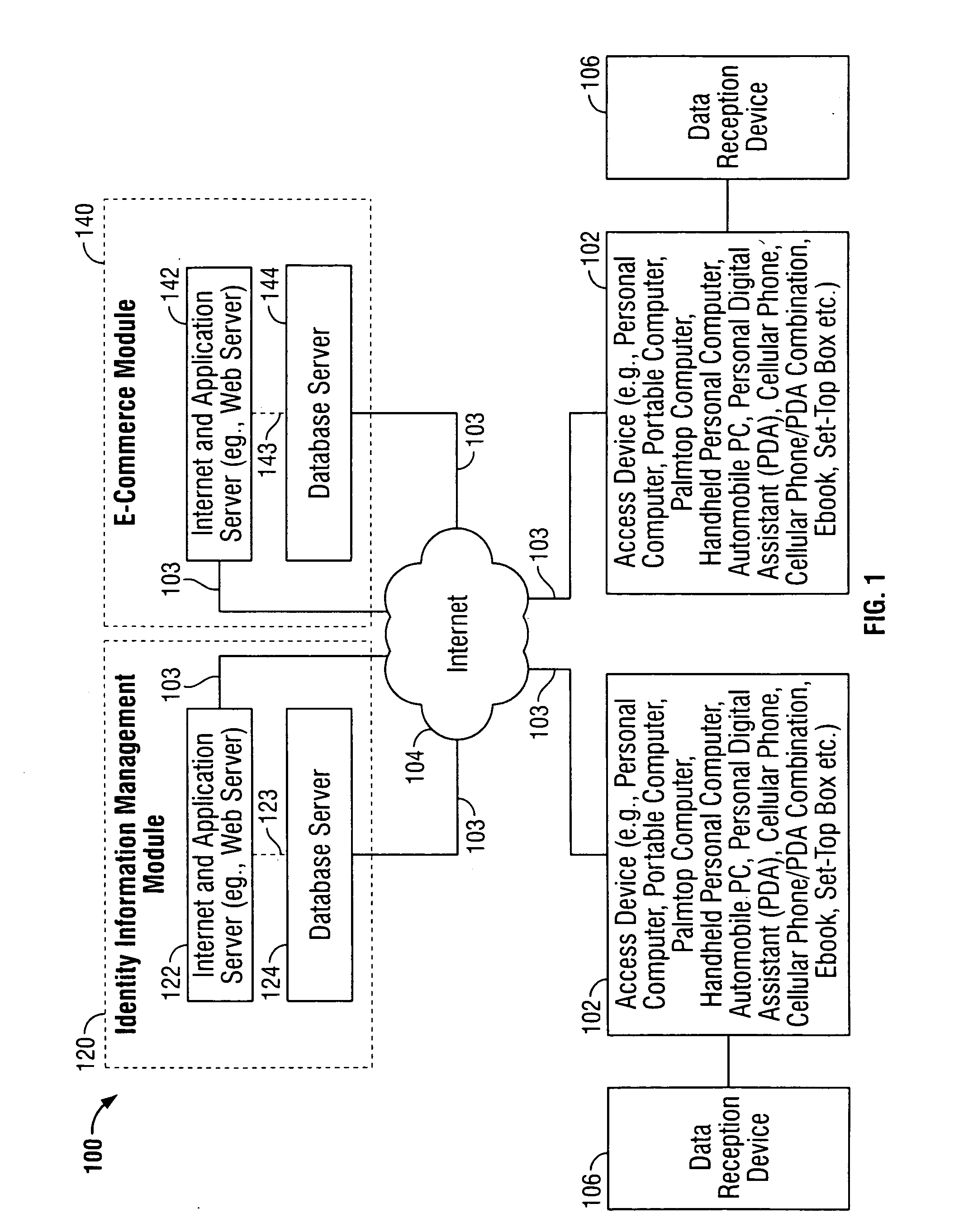

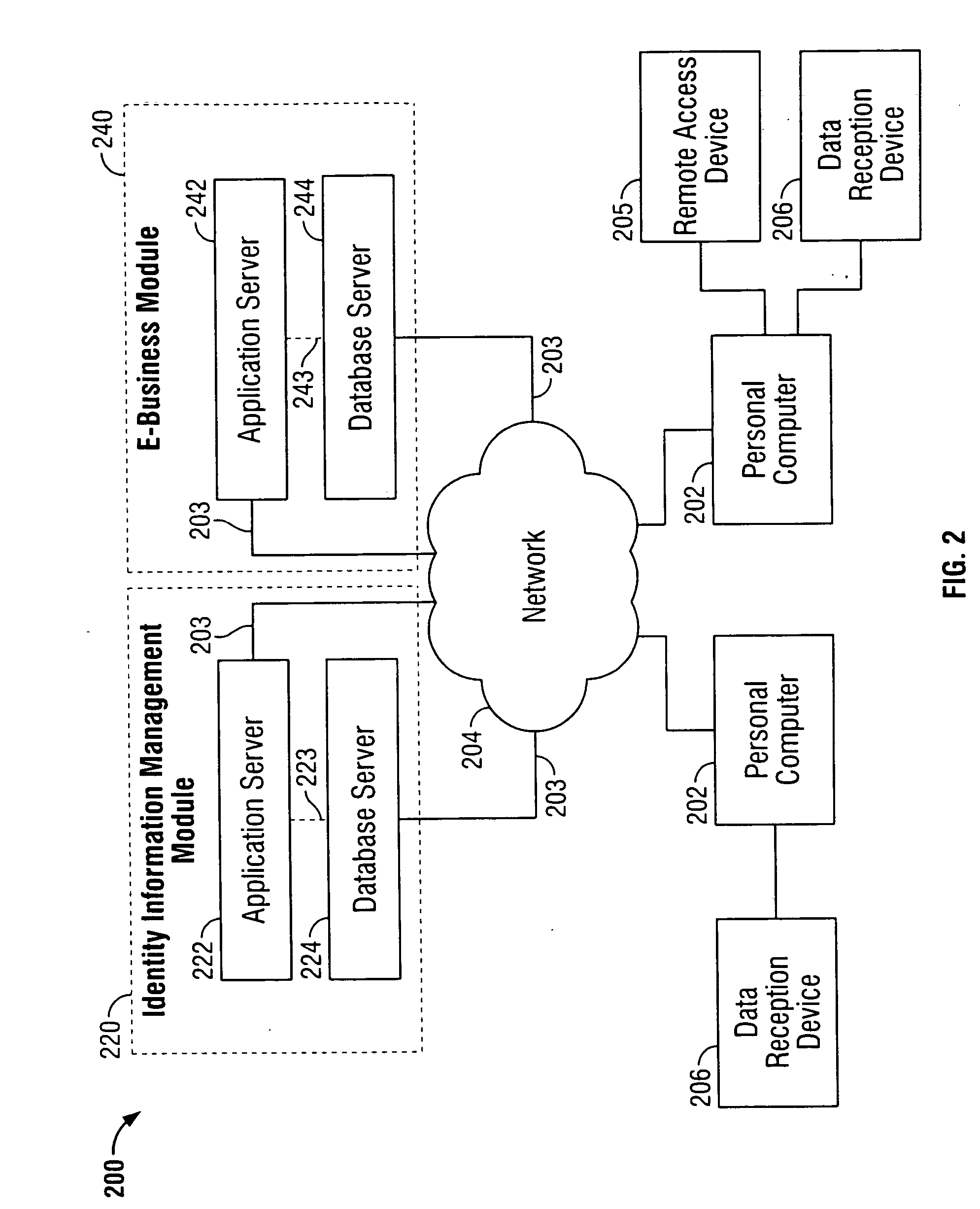

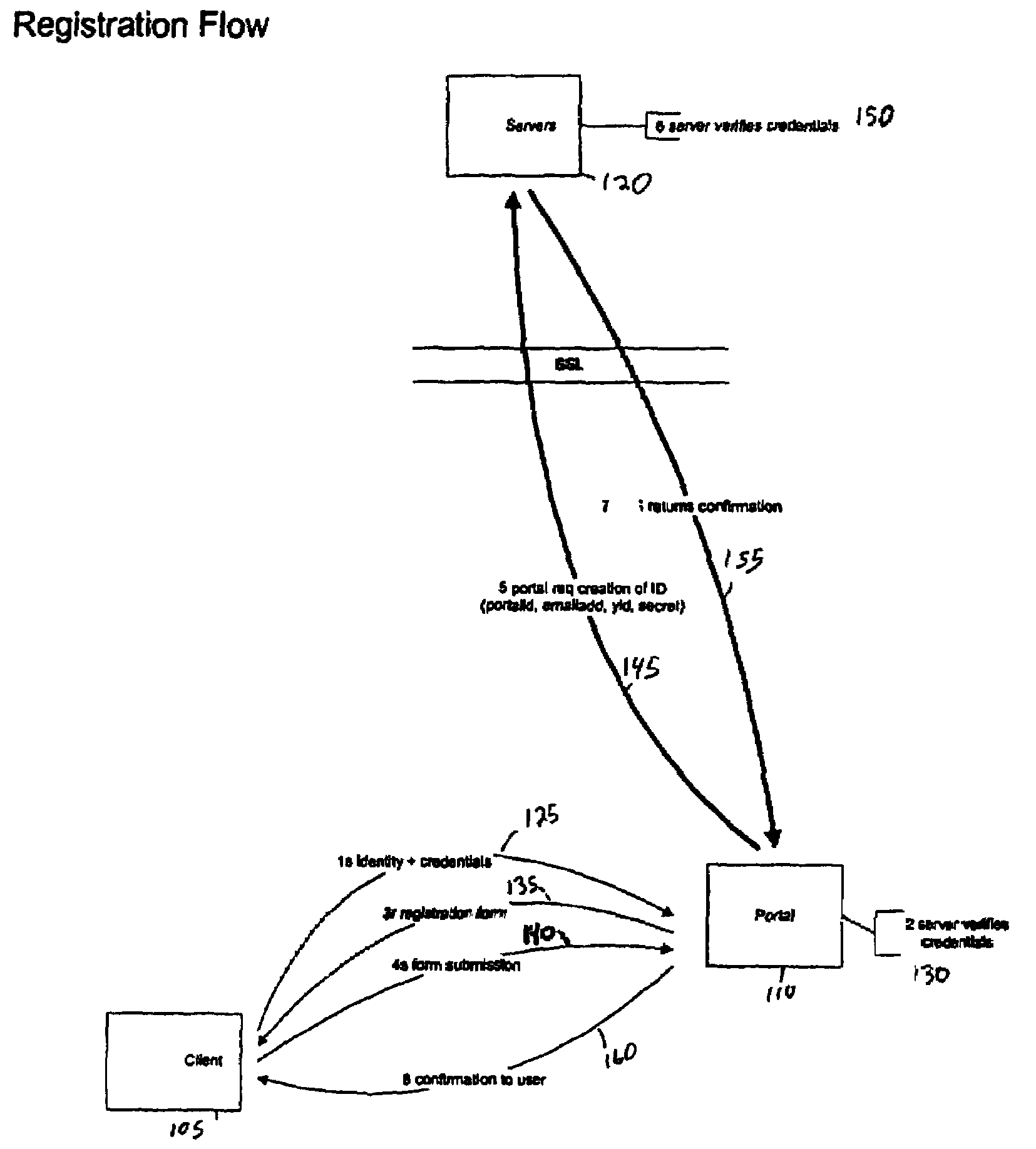

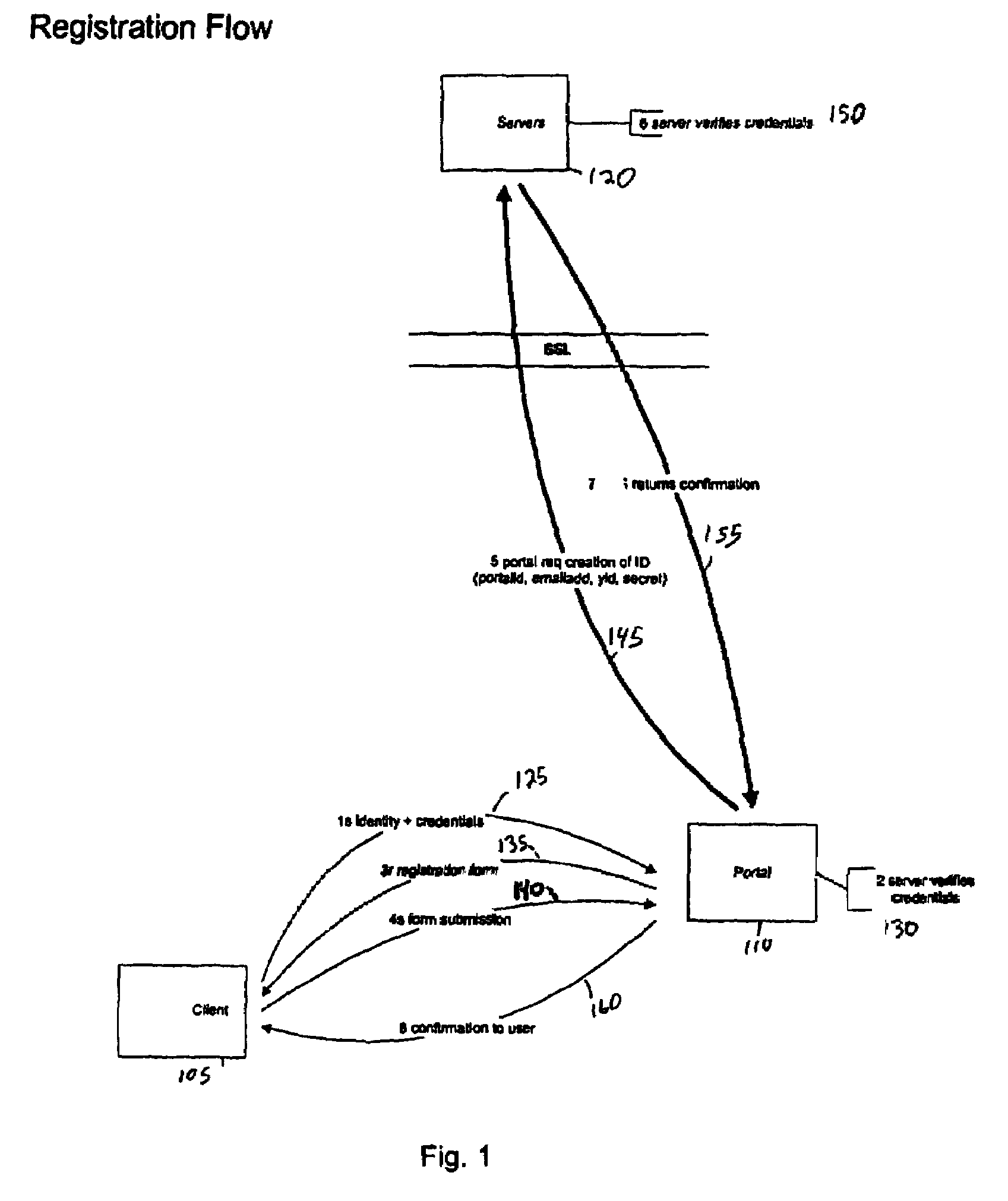

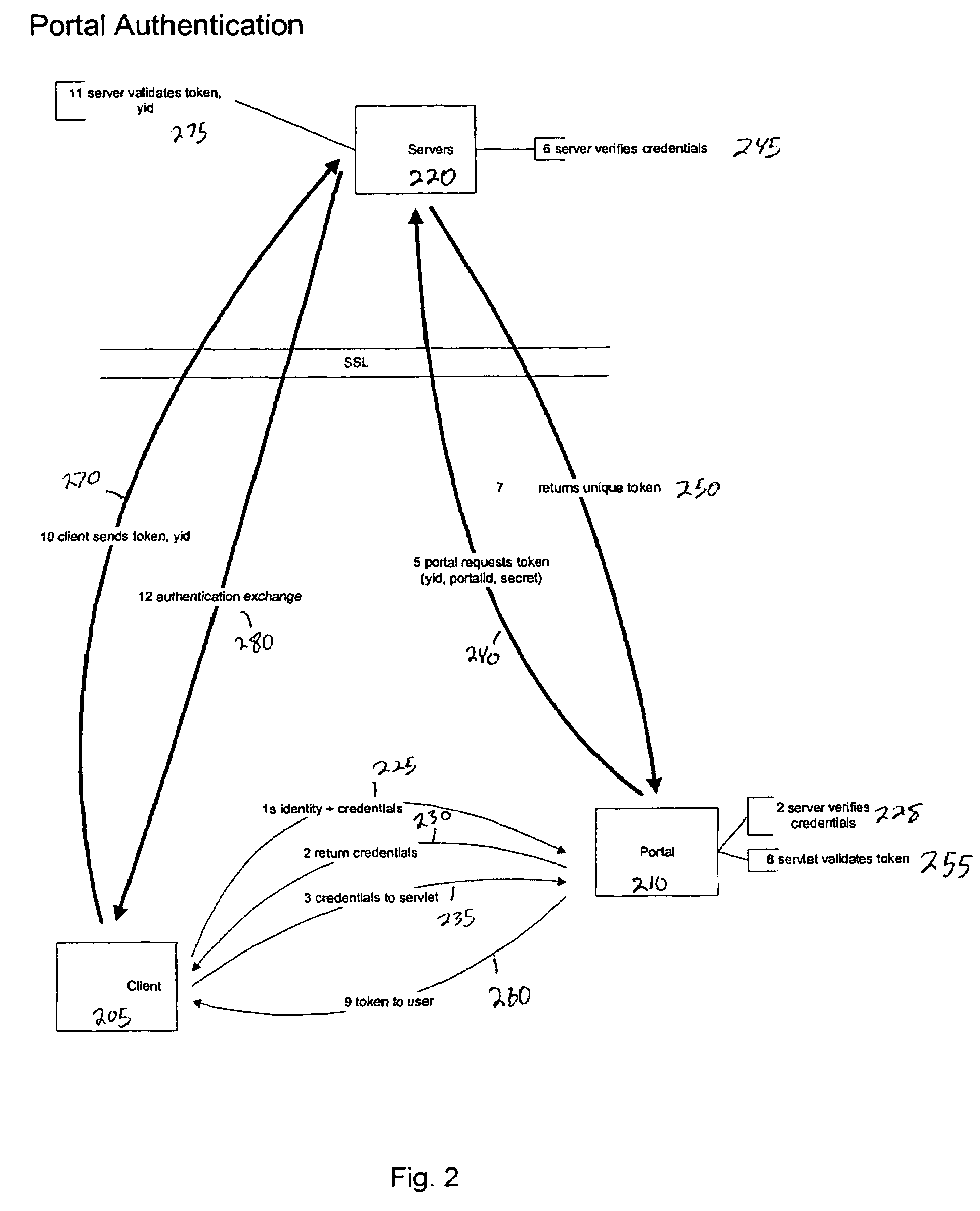

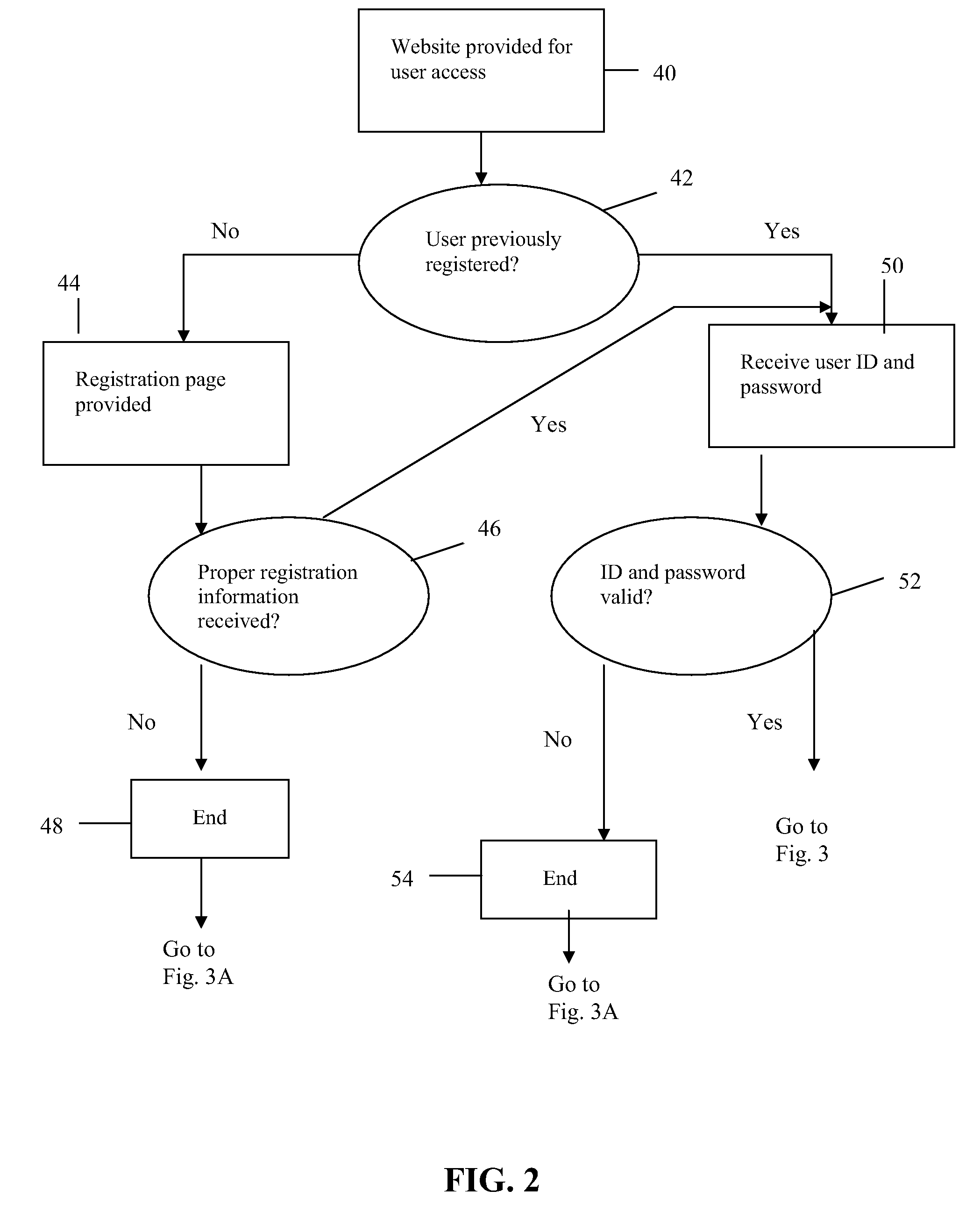

Centralized identity authentication for electronic communication networks

InactiveUS7140036B2Easy to carryReduce demandDigital data processing detailsUser identity/authority verificationWeb authenticationElectronic communication

A method of centralized identity authentication for use in connection with a communications network includes registering users of the communications network such that each registered user's identity is uniquely defined and determinable, and registering a plurality of vendors having a presence on the communications network. The registered vendors selectively transact with registered users, wherein the transactions include: (i) the registered vendor selling goods and / or services to the registered user; (ii) the registered vendor granting the registered user access to personal records maintained by the registered vendor; and / or (iii) the registered vendor communicating to the registered user personal information maintained by the registered vendor. The method also includes each user's identity being authenticated over the communications network prior to completion of transactions between registered vendors and registered users.

Owner:CARDINALCOMMERCE CORP +2

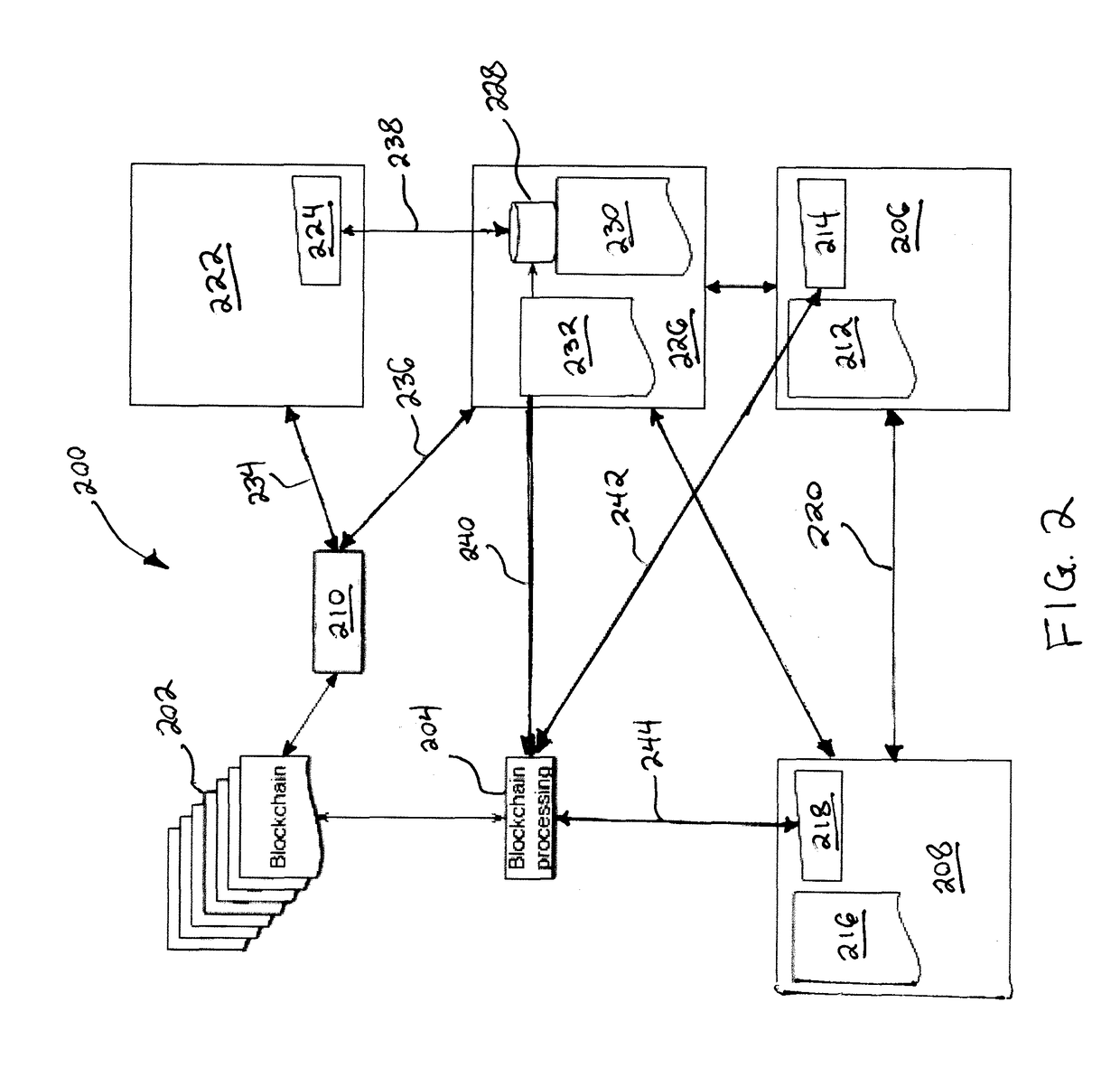

Blockchaining systems and methods for frictionless media

An ecosystem for distributing digital content over an electronic communications network includes a content creator computer system having a processor and a memory configured to store raw digital content. The system further includes computer systems for content service and for a retailer, both in operable communication with the processor. The content service computer system is configured to receive the raw digital content and transmit packaged digital content. The retailer computer system is configured to receive the packaged digital content and display its availability to an electronic device of a user. The ecosystem further includes a blockchain in operable communication with the processor, and the content service and retailer computer systems. The blockchain is configured to verify a transfer of the packaged digital content from the content service system to the user, a payment from the user to the retailer, and an update with information regarding the verified transfer and payment.

Owner:CABLE TELEVISION LAB

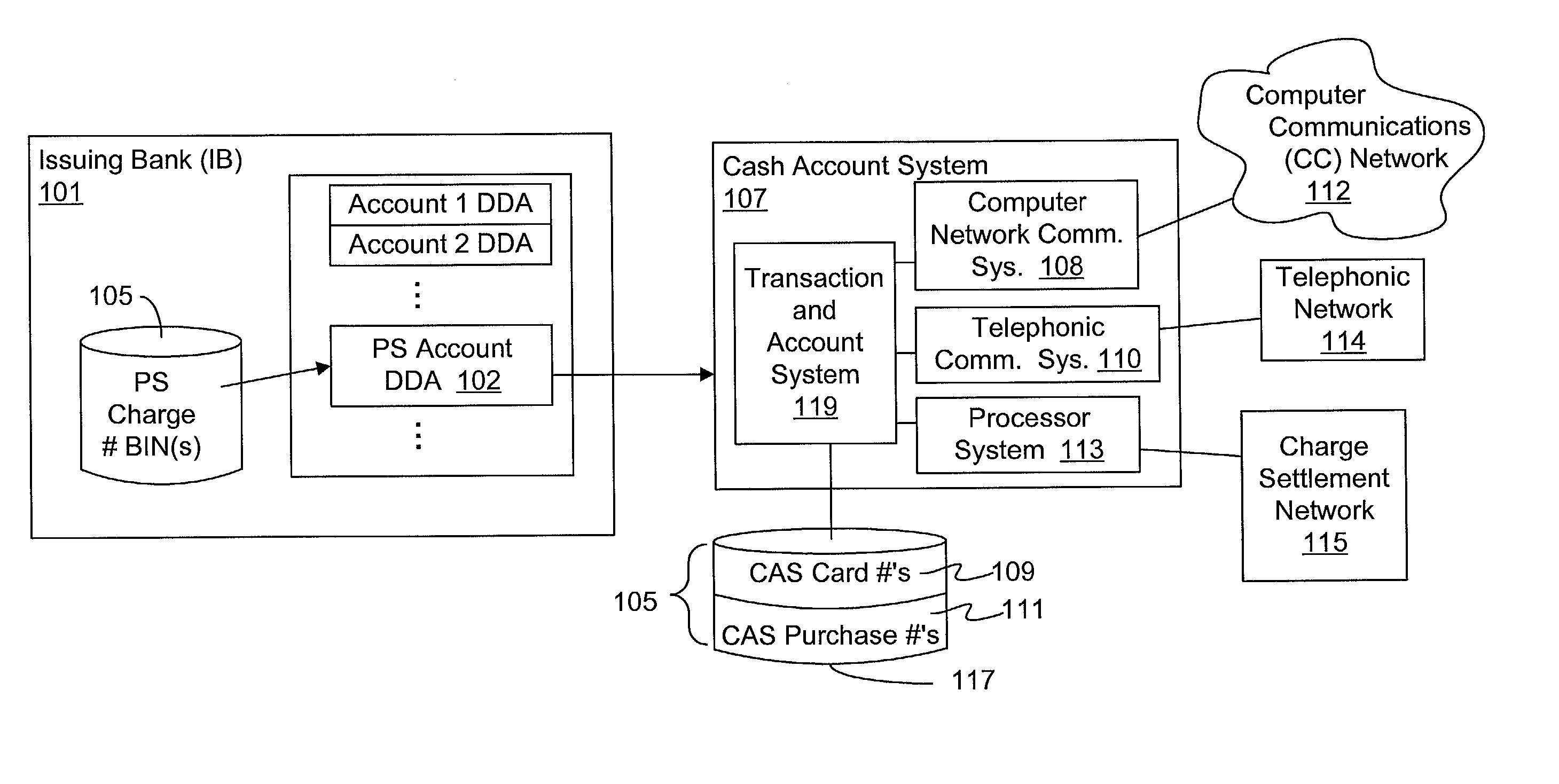

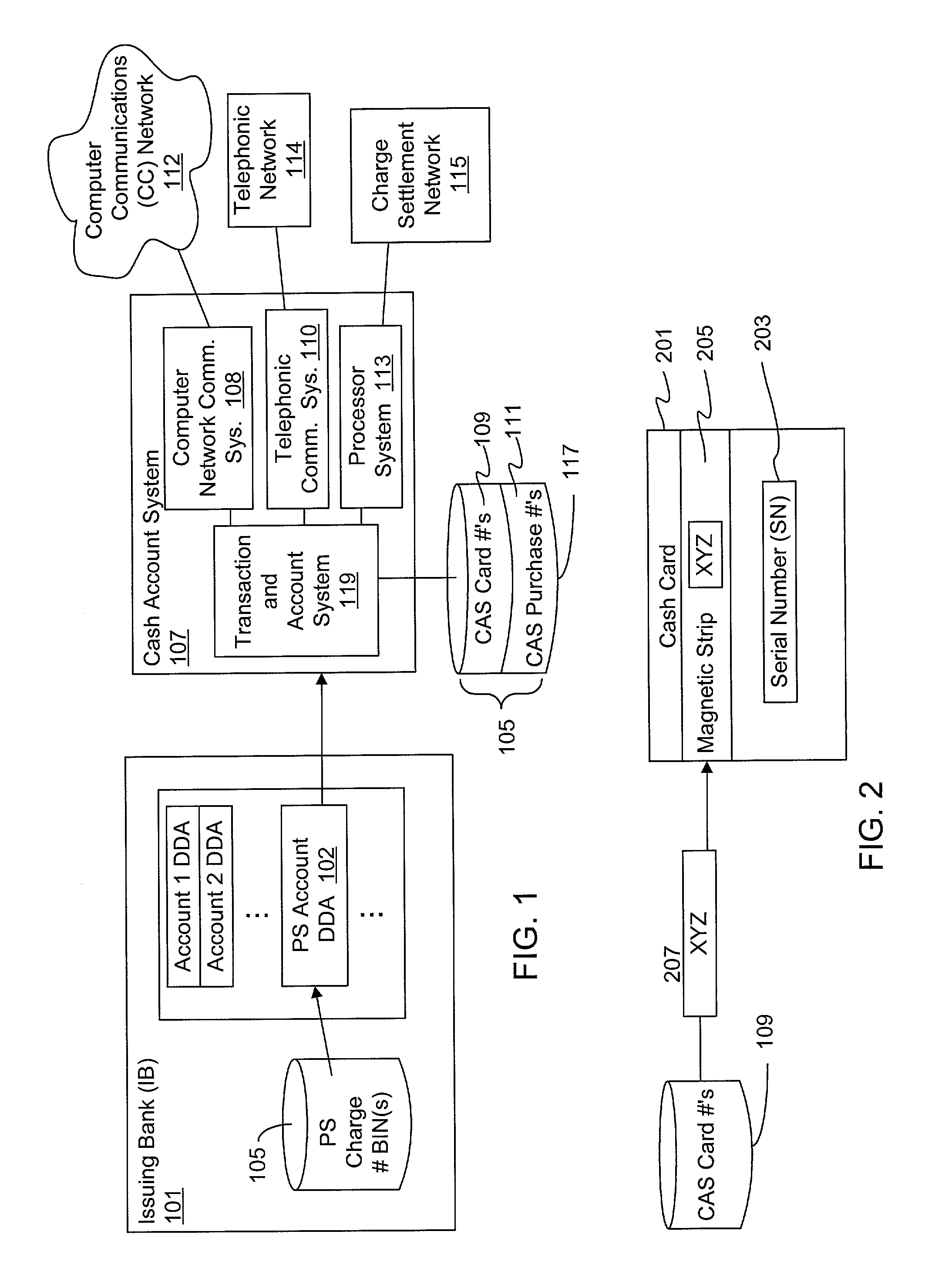

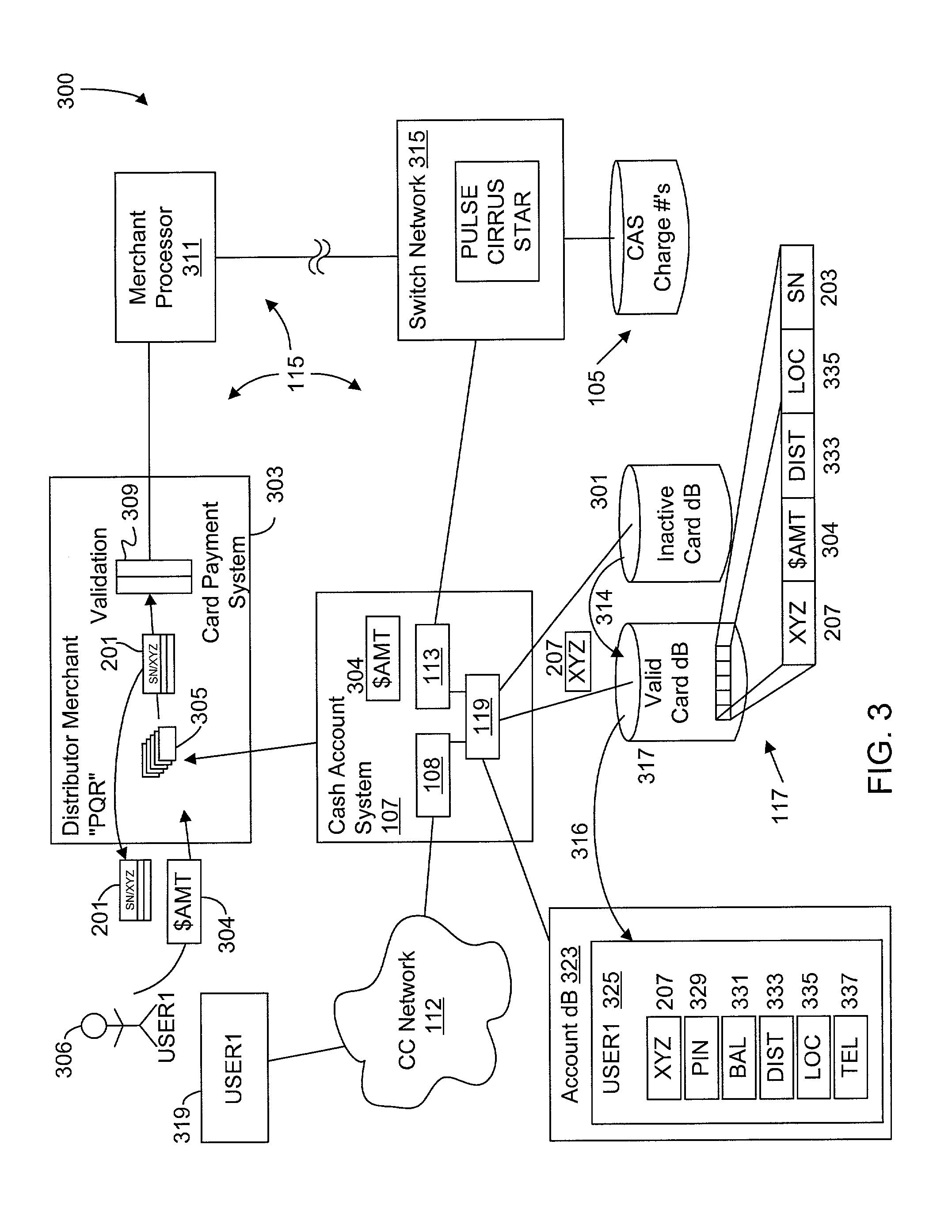

Online promotional scheme

InactiveUS20020099607A1Credit registering devices actuationDiscounts/incentivesPrint mediaElectronic communication network

A method of conducting a promotional scheme to identify potential customers and online cash account users in a cost-effective and efficient manner. The method includes publishing information via a public media including identification information that identifies the promotional scheme, receiving responses by entrants via an electronic communications network, creating an online cash account for each entrant, linking each online cash account created for each entrant to the identified promotional scheme, determining if a response is a winning response, and providing an online prize to at least one entrant that provided a winning response. The identification information may be existing manufacturer's serial numbers or new tokens printed on product packaging. A single token may be published or multiple different tokens may be published with one or more winning tokens. Publication is by any broadcast or print media. A convenient prize is an online cash account loaded with cash.

Owner:NETABPEND CORP

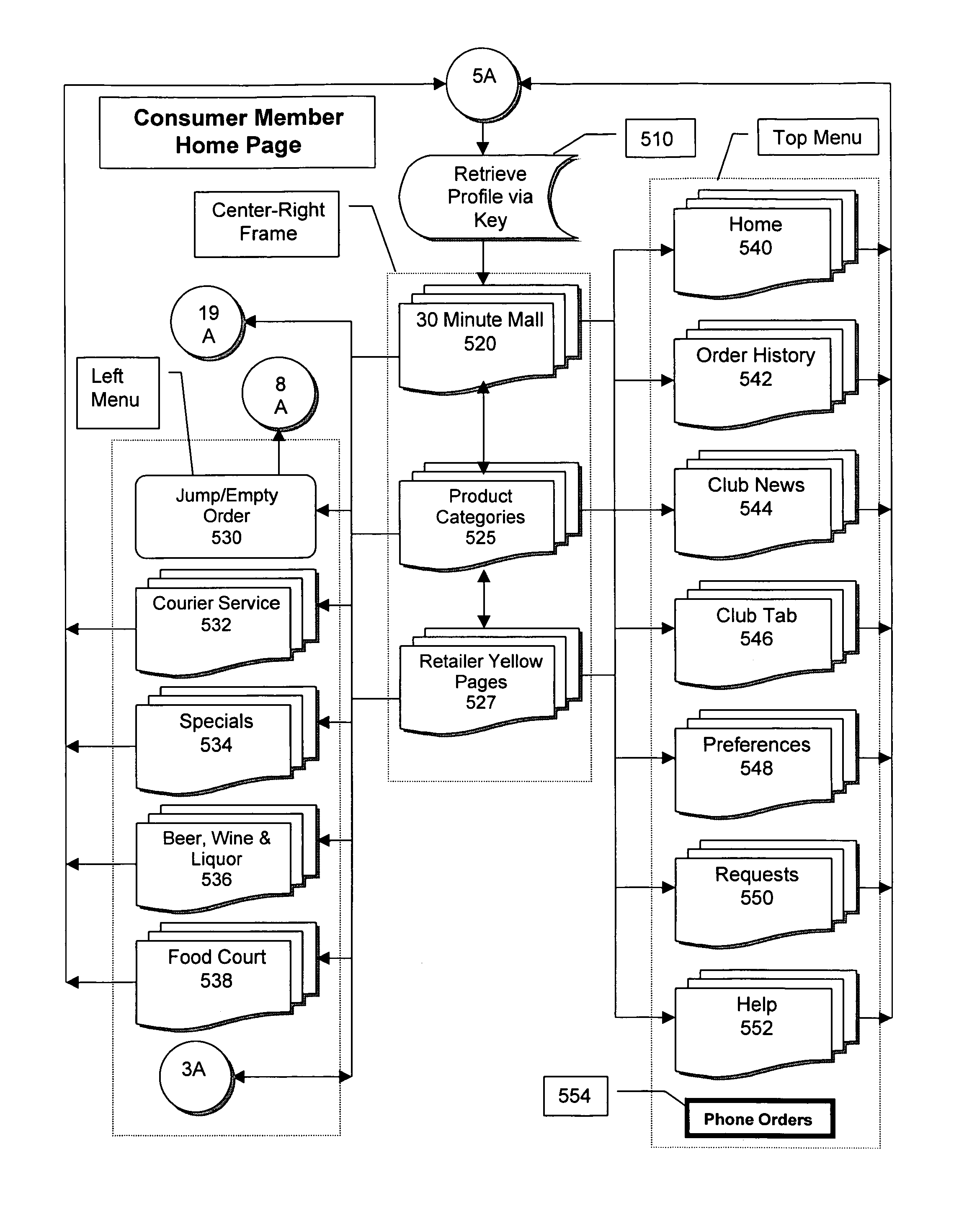

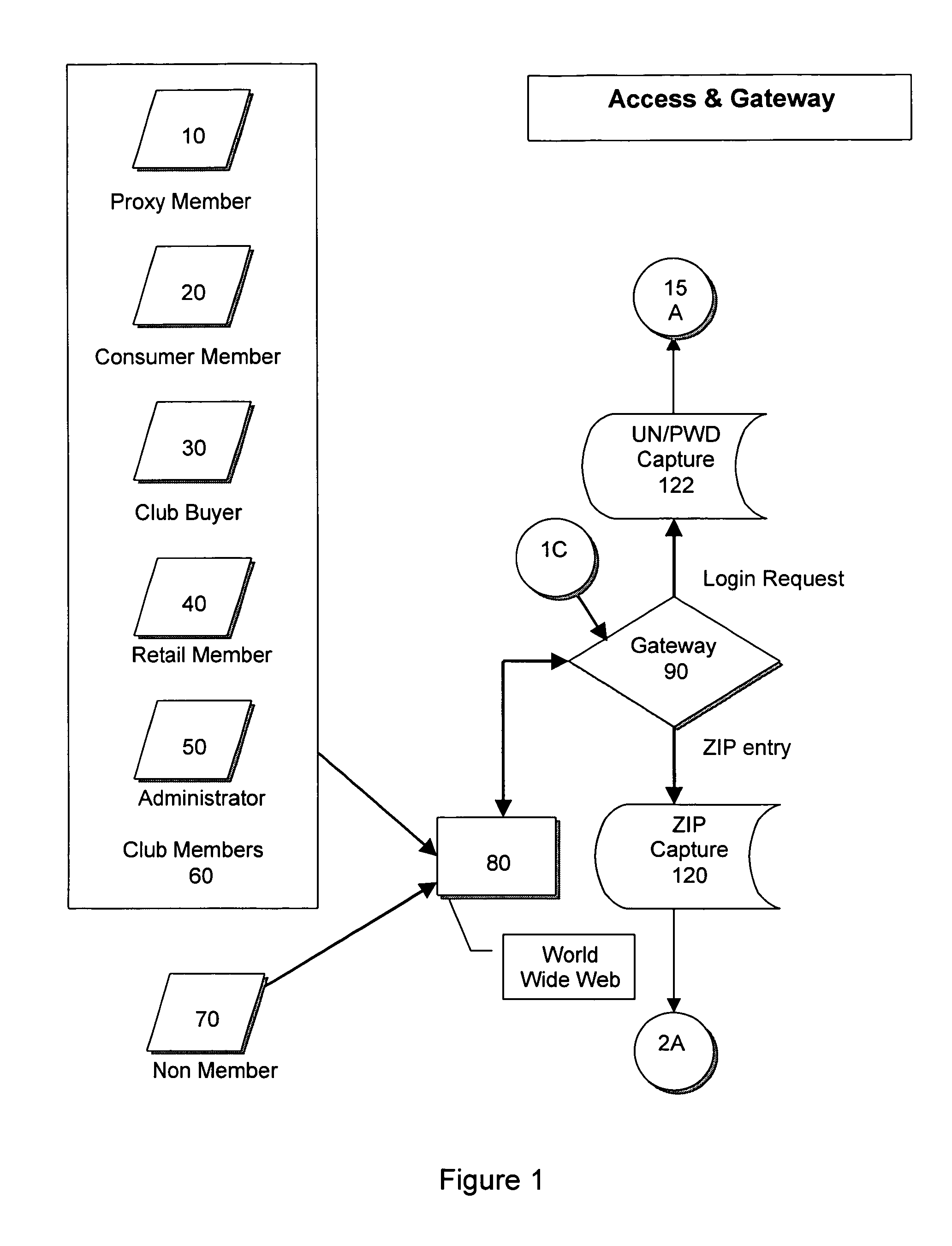

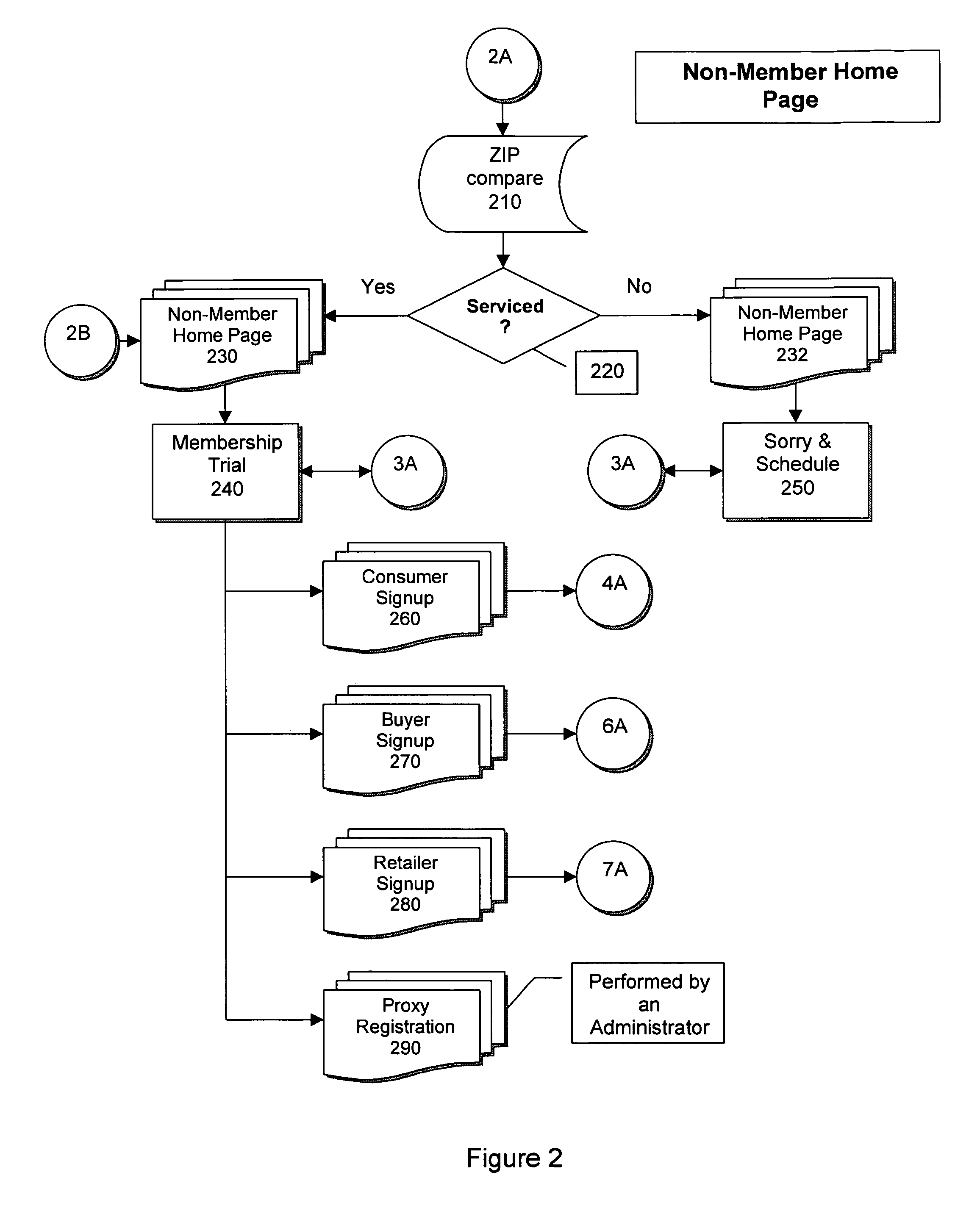

Fully integrated on-line interactive purchasing club incorporating extremely rapid fulfillment

InactiveUS7082409B1Low costValue maximizationBuying/selling/leasing transactionsMarketingWeb sitePersonalization

A method for implementing a computer-based product purchase and fulfillment club is disclosed, comprising the steps of designating one or more geographic club member areas; associating with each such club member area one or more consumer members who reside within the club member area and who must agree to pay a membership fee to the club; associating with each such club member area one or more buyer members who must be prepared to work within the club member area and who must agree to pay a membership fee to the club; associating with each such club member area one or more retailer members who must offer products for sale within the club member area and who must agree to pay a membership fee to the club; providing means through an electronic communications network for the consumer members, buyer members and retailer members to access a club web site specific to the club member area and to interact with the club web site; providing means through an electronic communications network for the consumer members, buyer members and retailer members to each access an individual member web page located on the club web site and personalized using parameters specific to each such consumer member, buyer member and retailer member; providing means through software programming for the retailer members to offer one or more products for sale on the club web site to the consumer members; providing means through software programming for the consumer members to purchase products offered for sale on the club web site; providing means through software programming for the buyer members to be notified of purchases made by the consumer members and to offer to the retailer members to fulfill the purchases; and fulfilling the purchases by having the buyer members buy the products from the retailer members, deliver the products to the consumer members to a location within the club member area within approximately thirty (30) minutes of the purchase, and collect a payment from the consumer members.

Owner:CHERRY RICHARD SUTTON

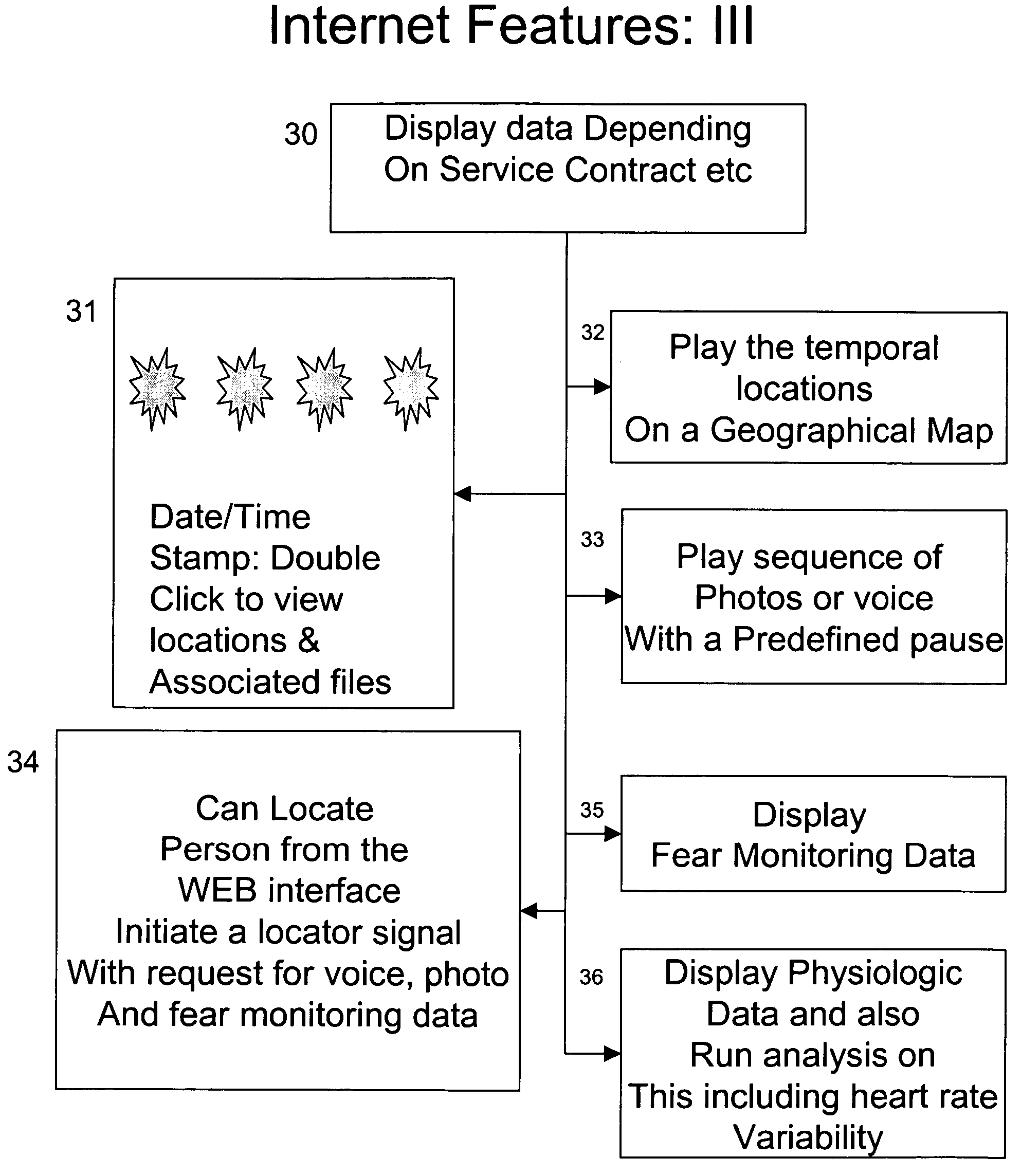

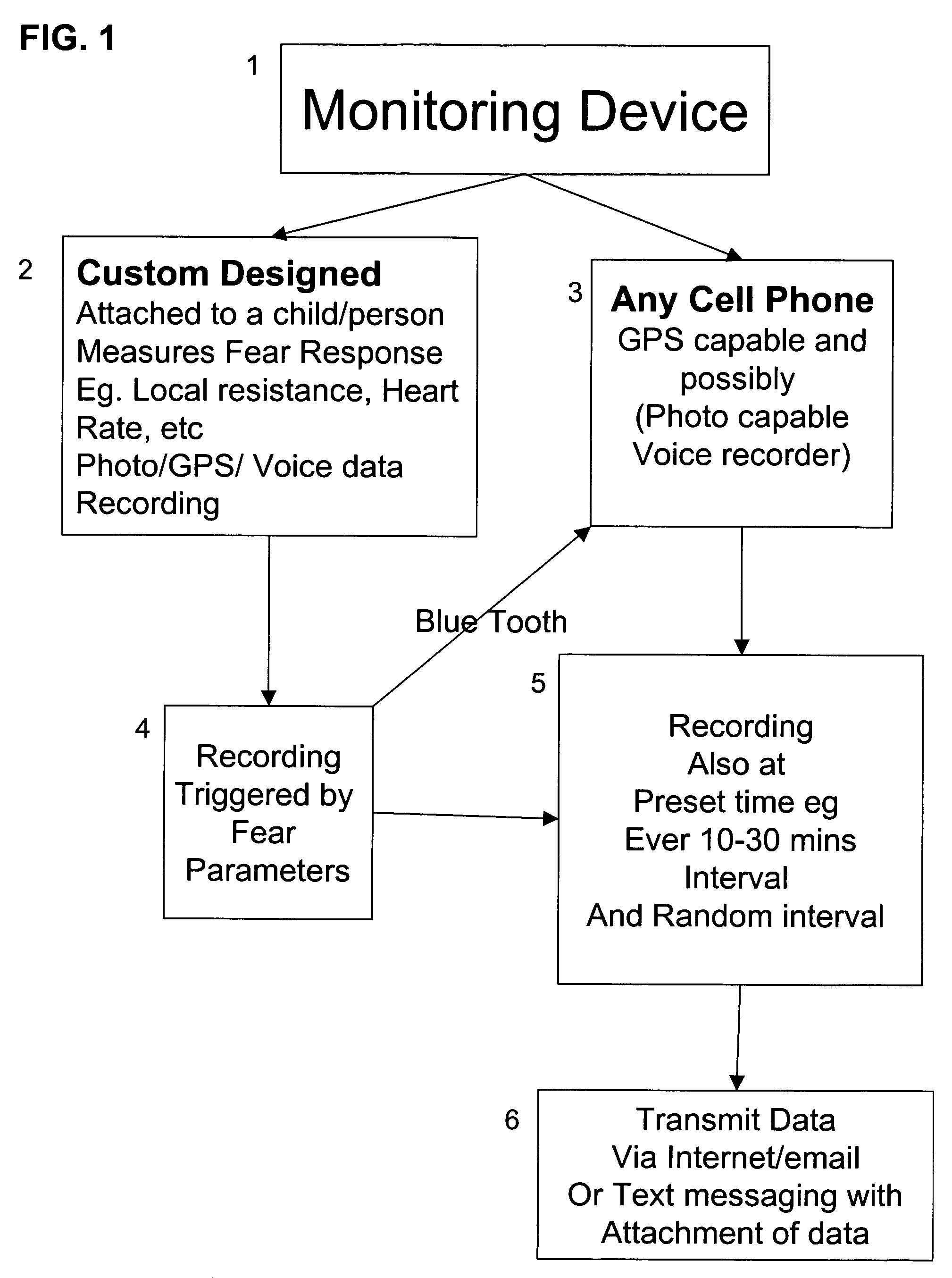

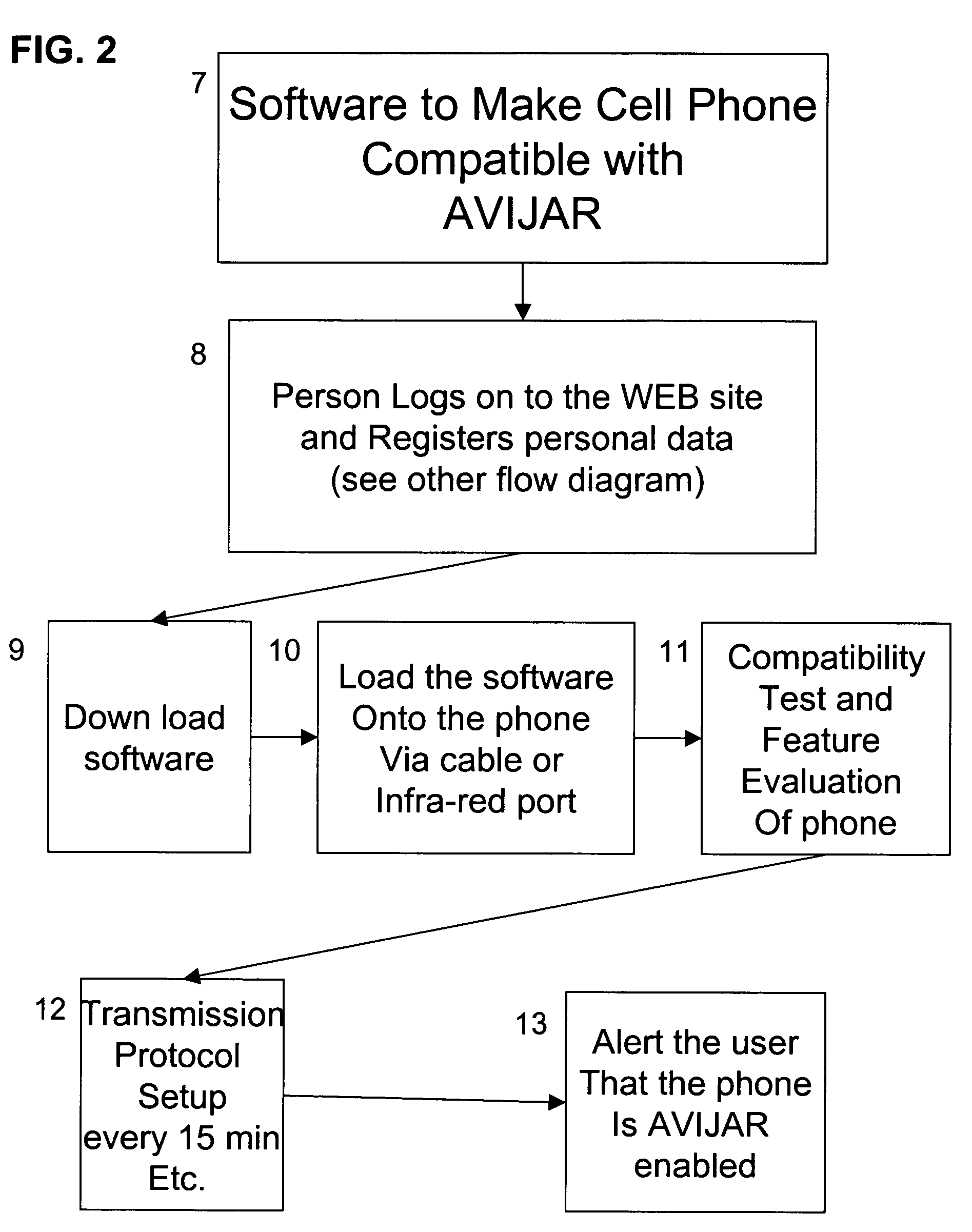

Systems and methods for remote monitoring of fear and distress responses

InactiveUS7297110B2SurgeryDiagnostic recording/measuringElectronic communication networkReal-time computing

Owner:GOYAL MUNA C +1

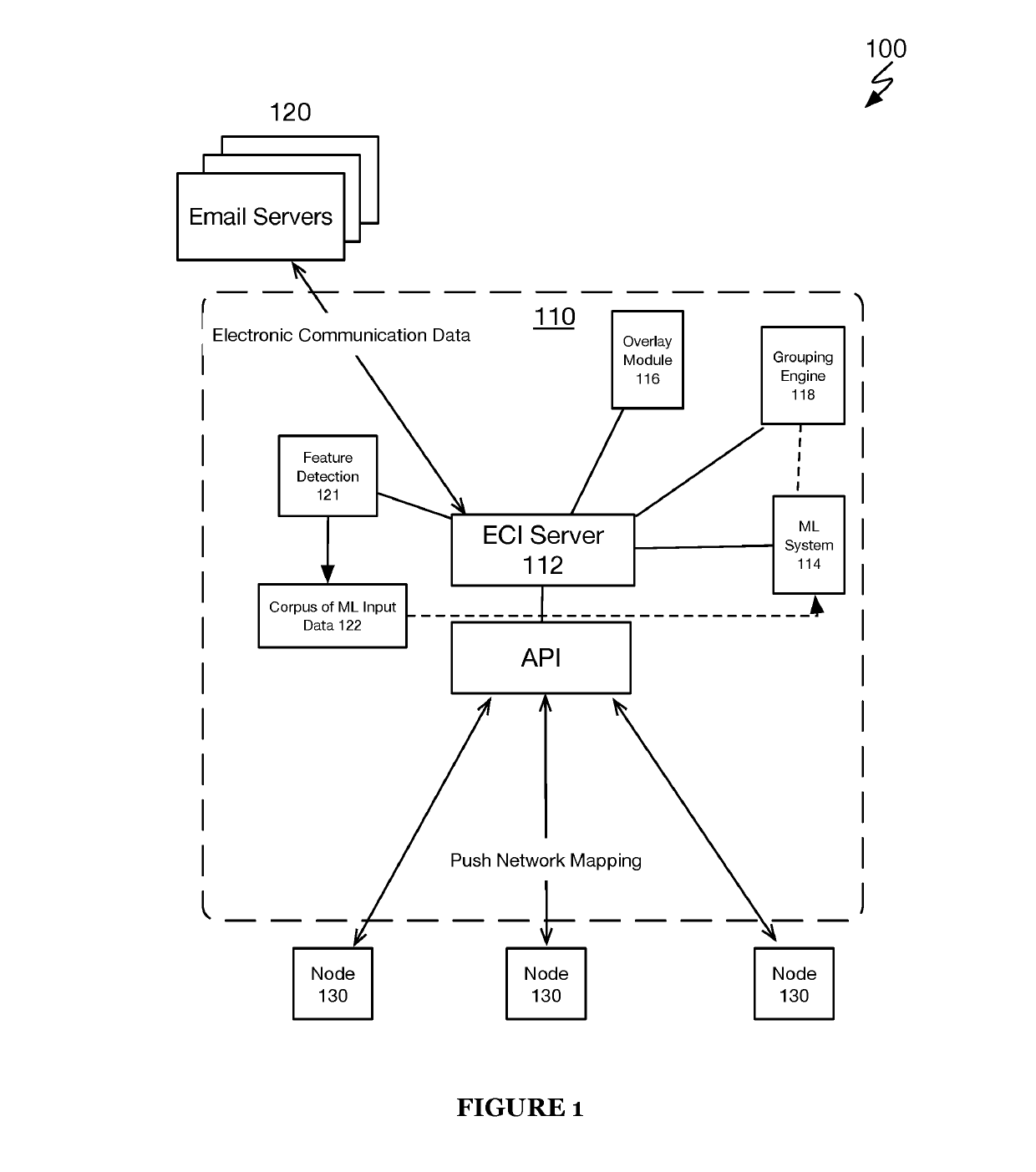

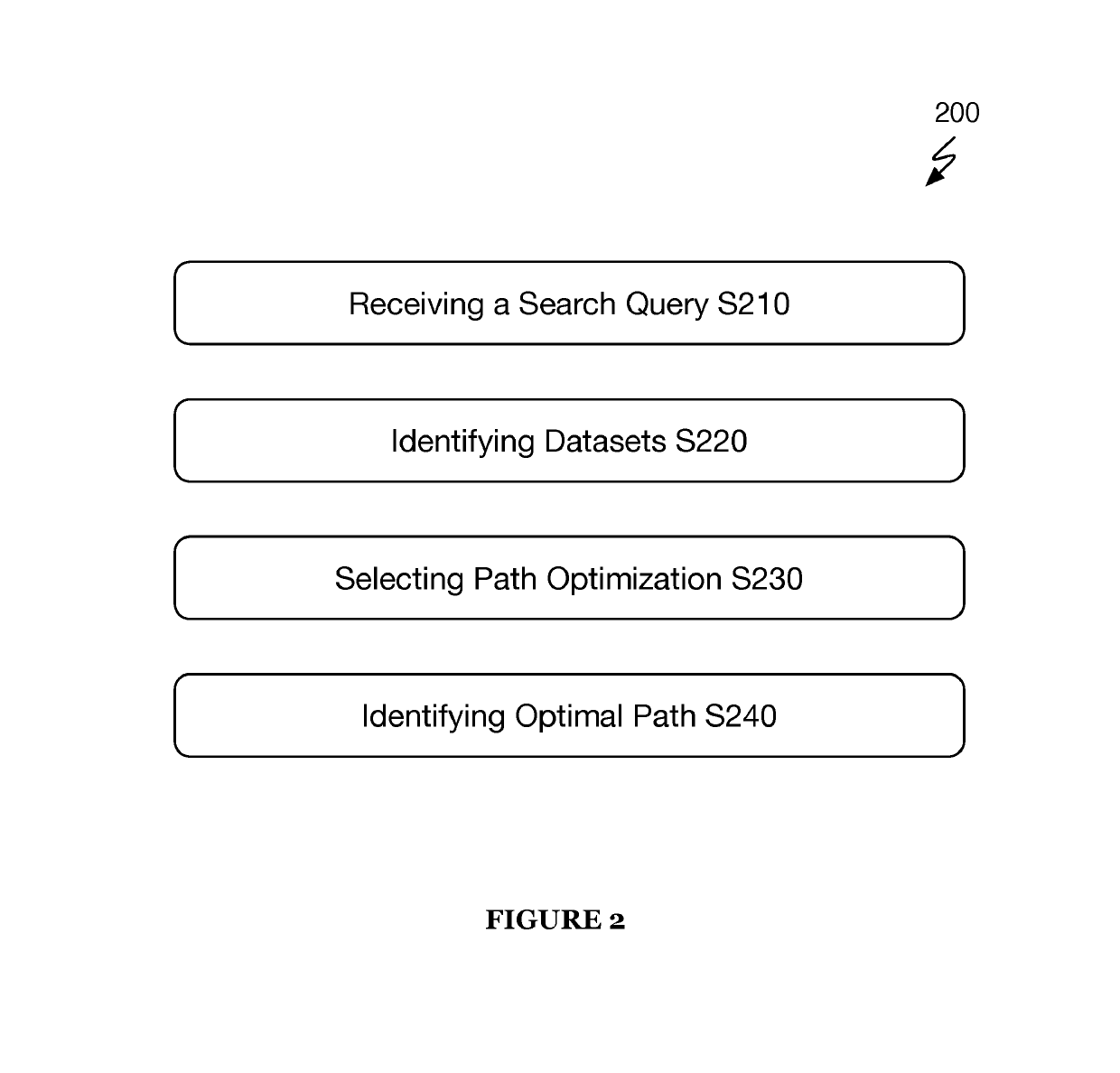

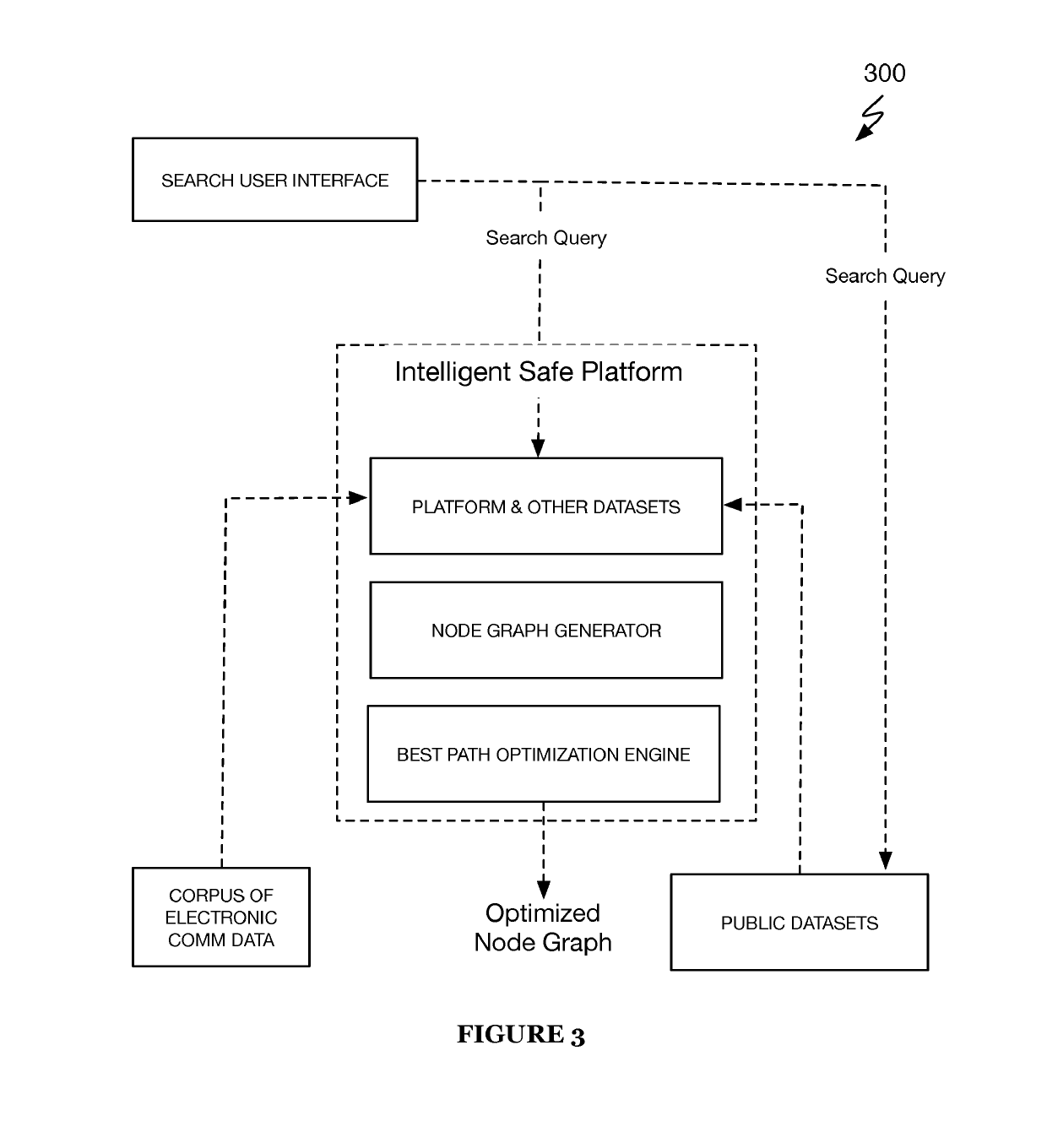

Systems and method for communications routing based on electronic communication data

ActiveUS20190140988A1Efficient routingEnsemble learningKernel methodsThird partyElectronic communication

A system and method includes at the online electronic communications service: receiving a search query from a source communication node; accessing historical electronic communication data associated with the source communication node and a plurality of online communication nodes from one or more third-party online communication services; constructing an electronic communication network mapping of communication nodes between the source communication node and each of the plurality of online communication nodes, wherein constructing includes: measuring communication metrics and / or connectivity metrics among the source communication node and the plurality of online communication nodes at least one communication metric or at least one connectivity metric between pairs of online communication nodes within the electronic communication network mapping based on the measuring; and returning an identification of one or more online communication nodes that satisfy one or more search facets of the search query based on the electronic communication network mapping.

Owner:NOTION AI

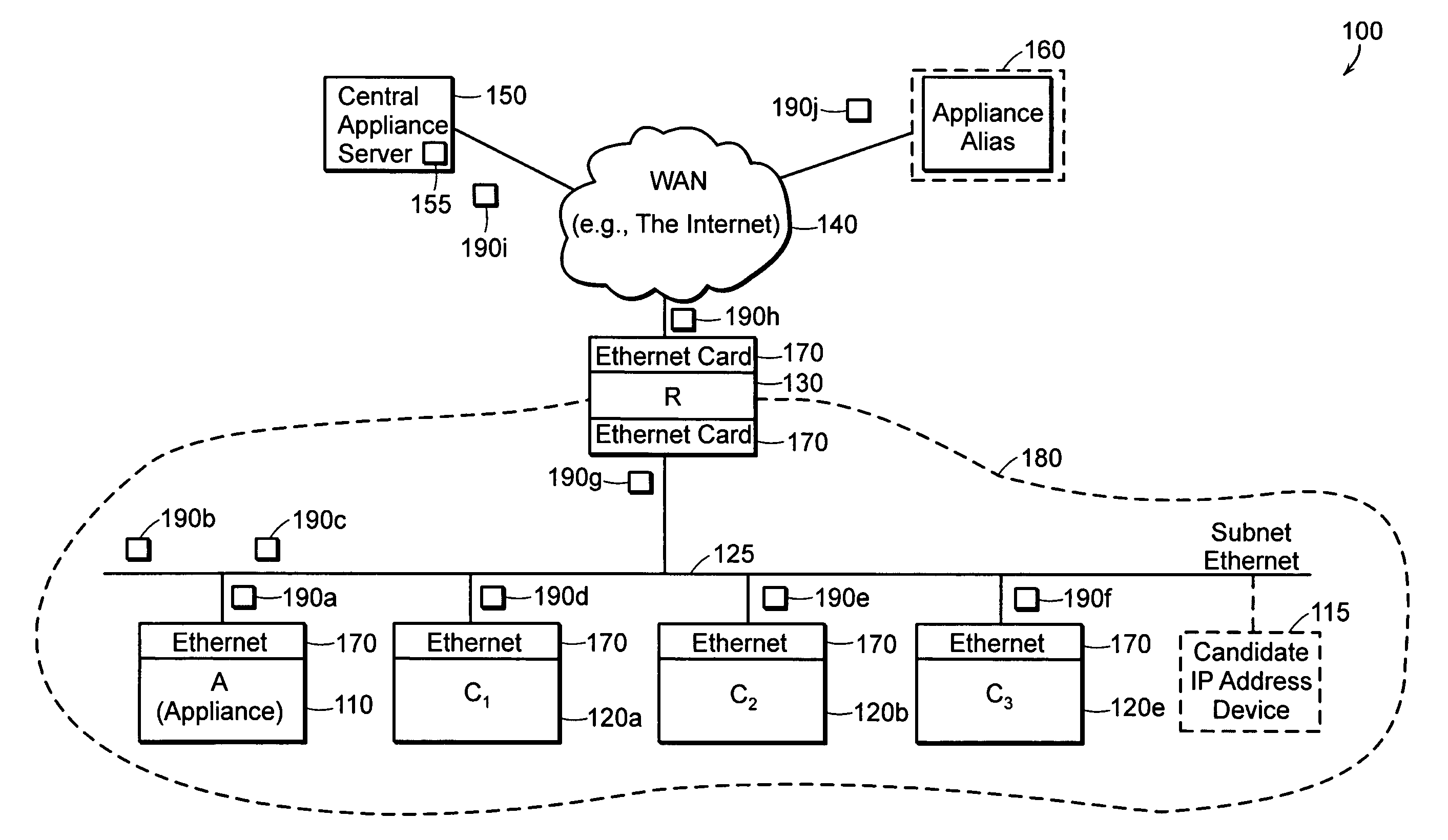

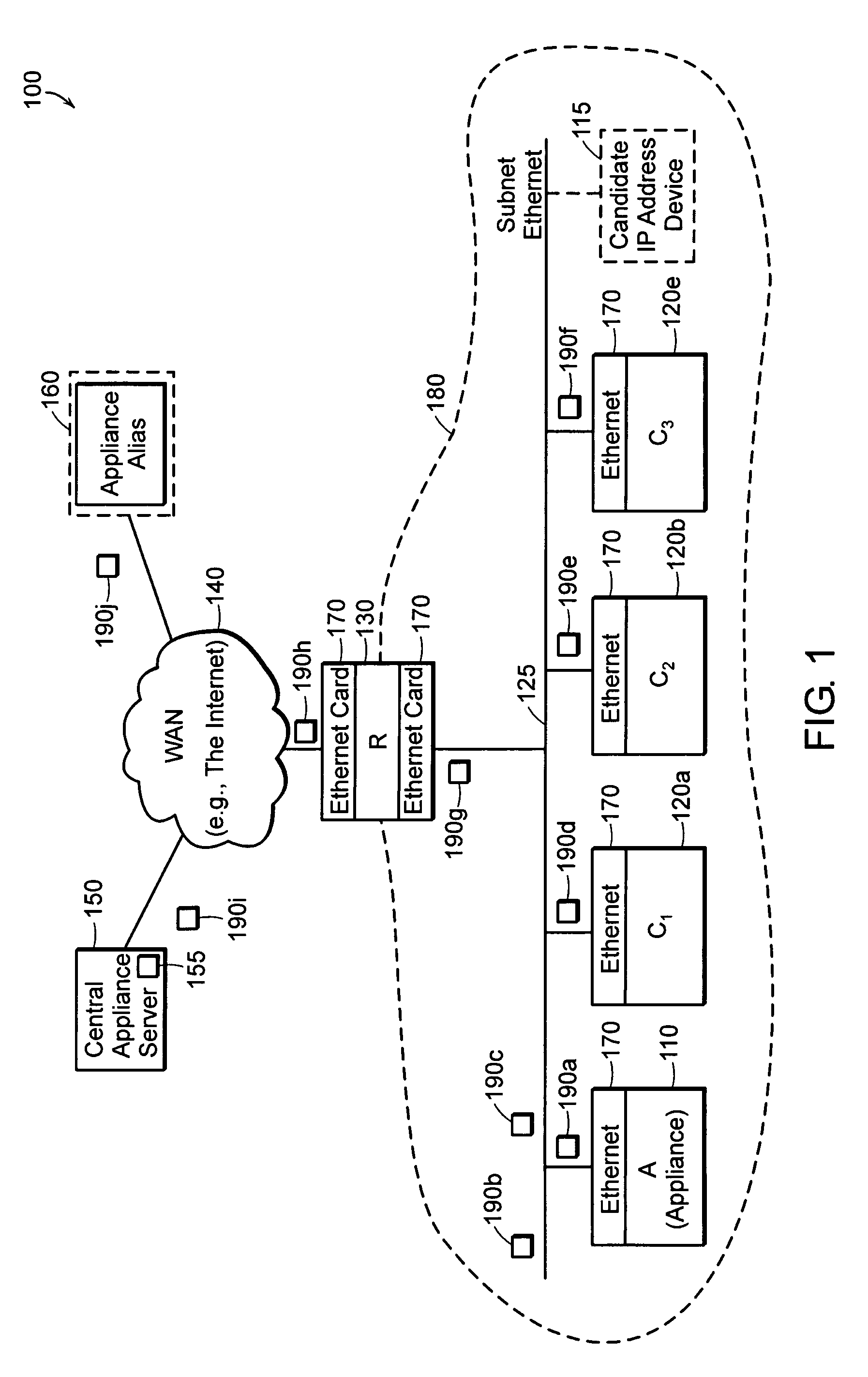

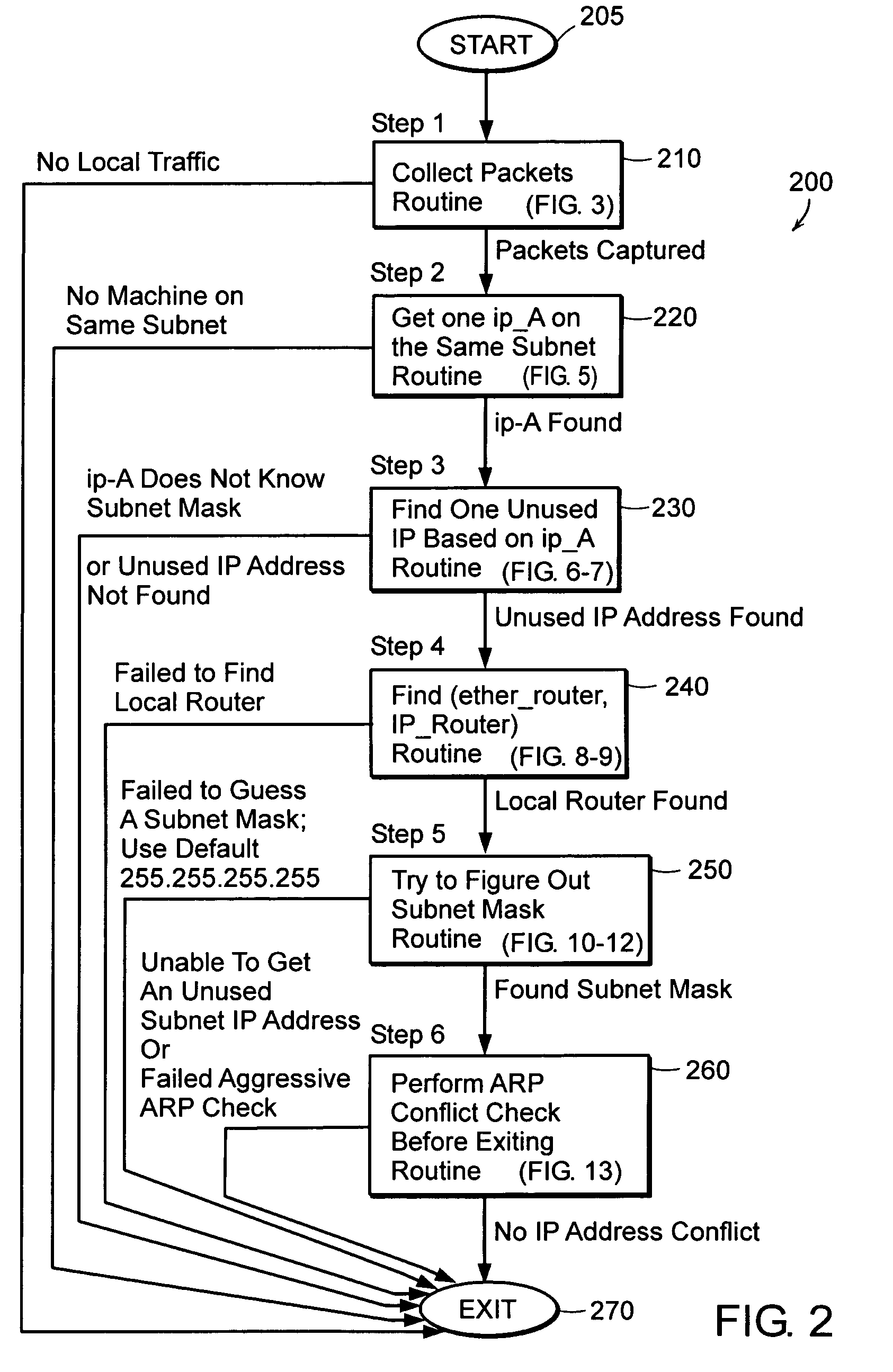

Method and apparatus for automatic network address assignment

The present invention includes a method and apparatus for automatically assigning a network address to a network device in an electronic communications network carrying inter-device communication packets to and from electronic devices located at assigned network addresses. The network device, also referred to as an appliance, communicates with at least one other network device to collect information from inter-device communication packets, which contain network address assignment information. From the network address assignment information in the communication packets, the appliance determines an available network address. The appliance assumes the available network address. The appliance may access a remote network device to retrieve an available, permanent, network configuration, including IP address.

Owner:CISCO TECH INC

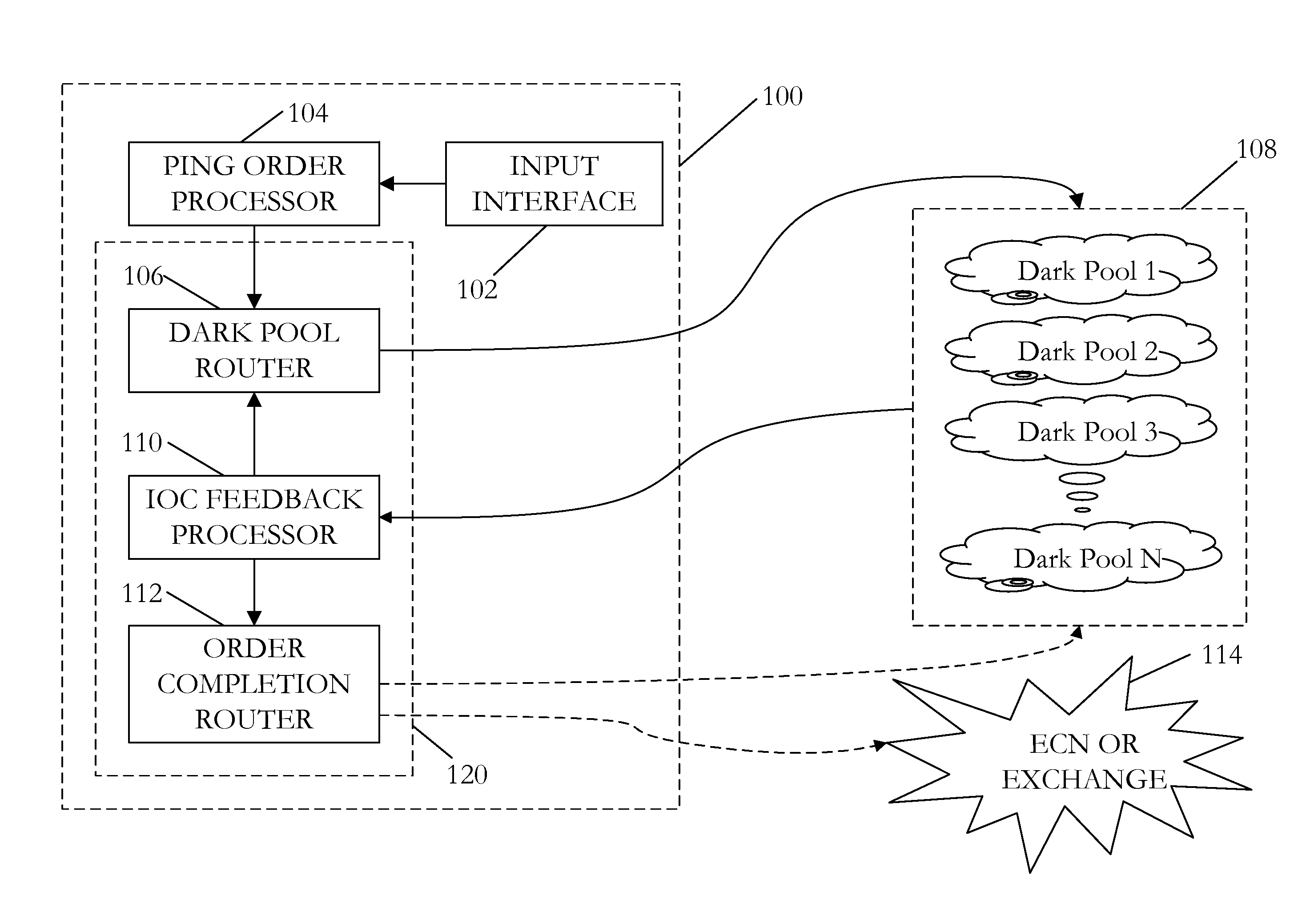

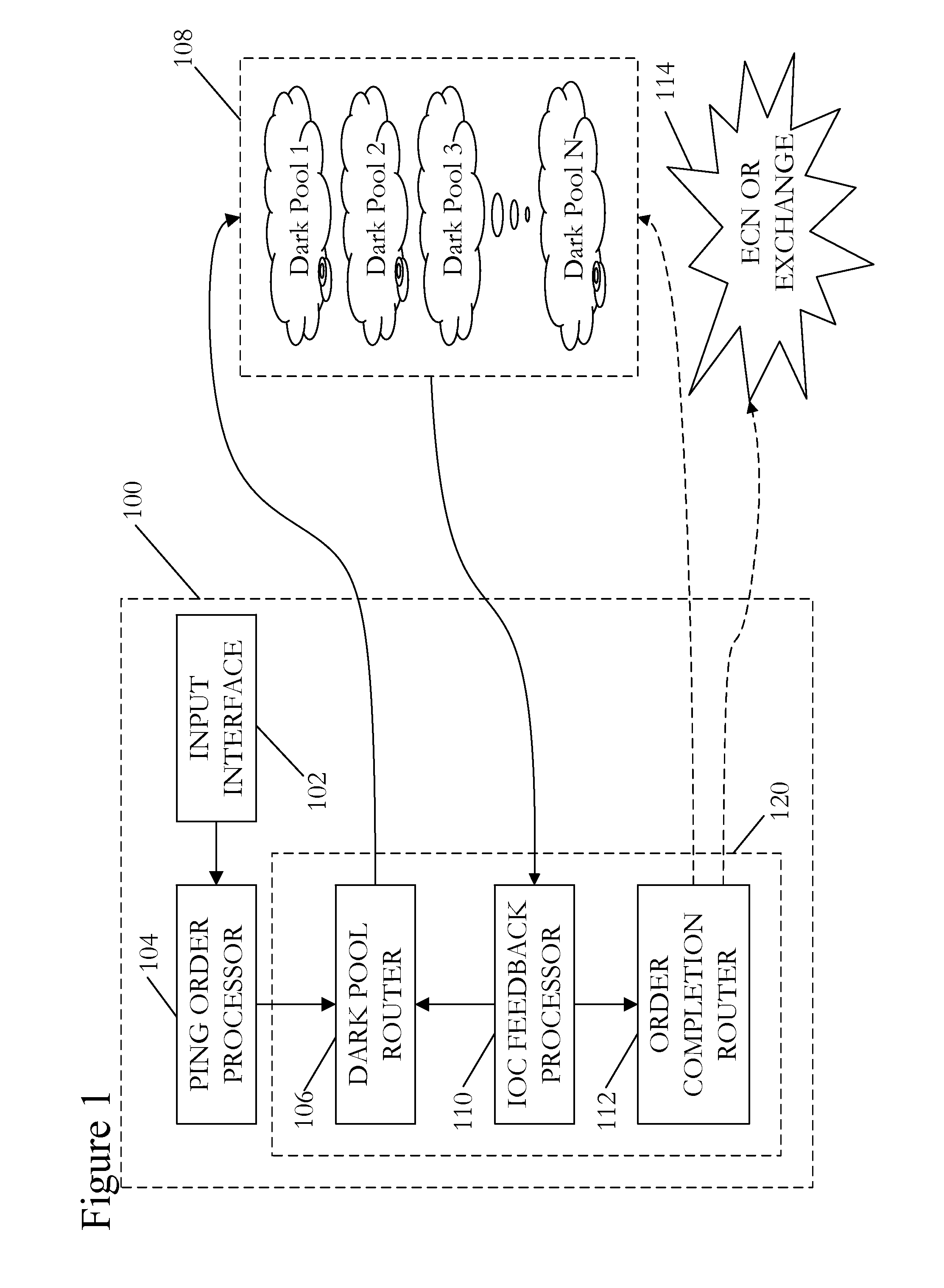

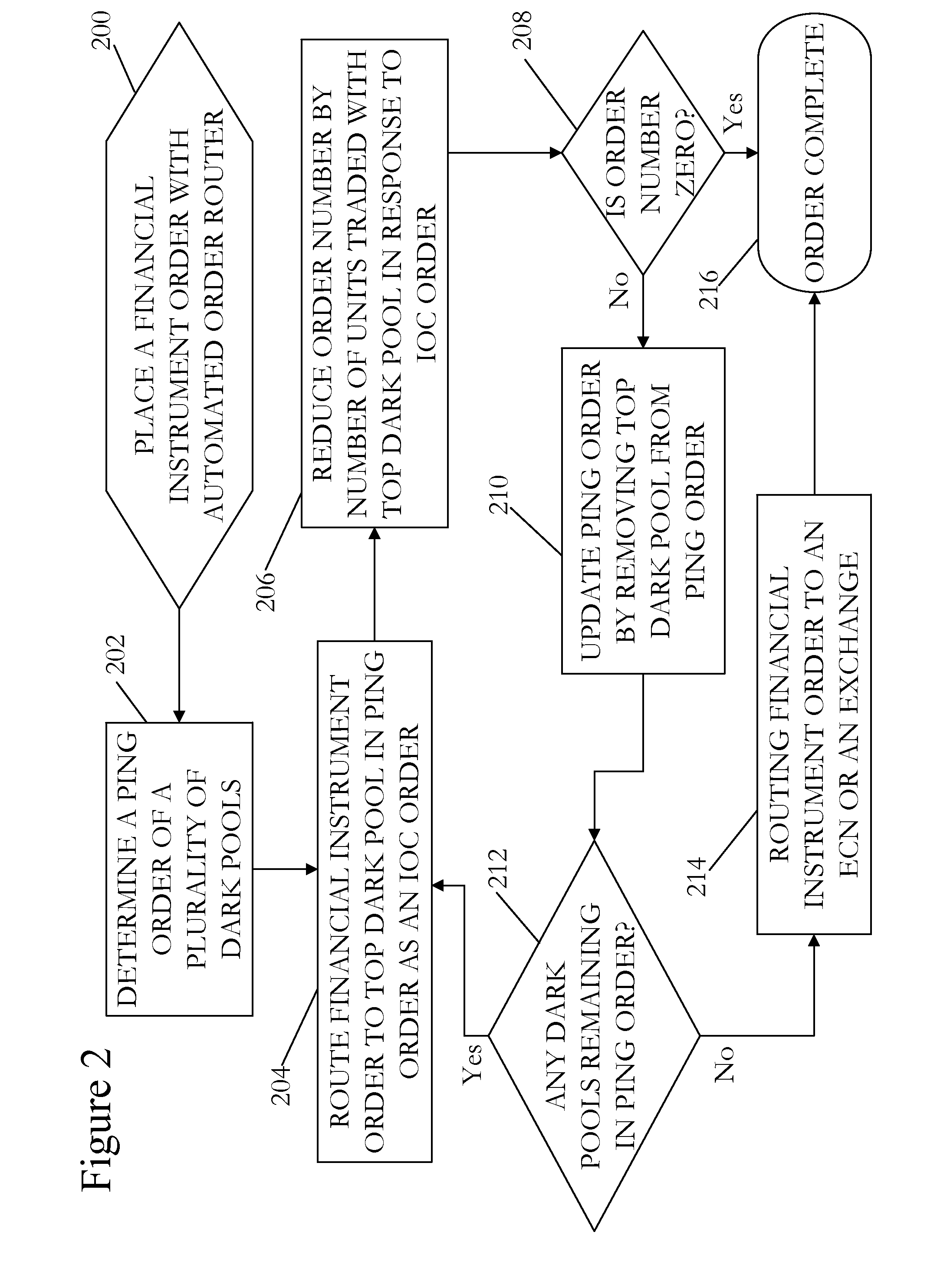

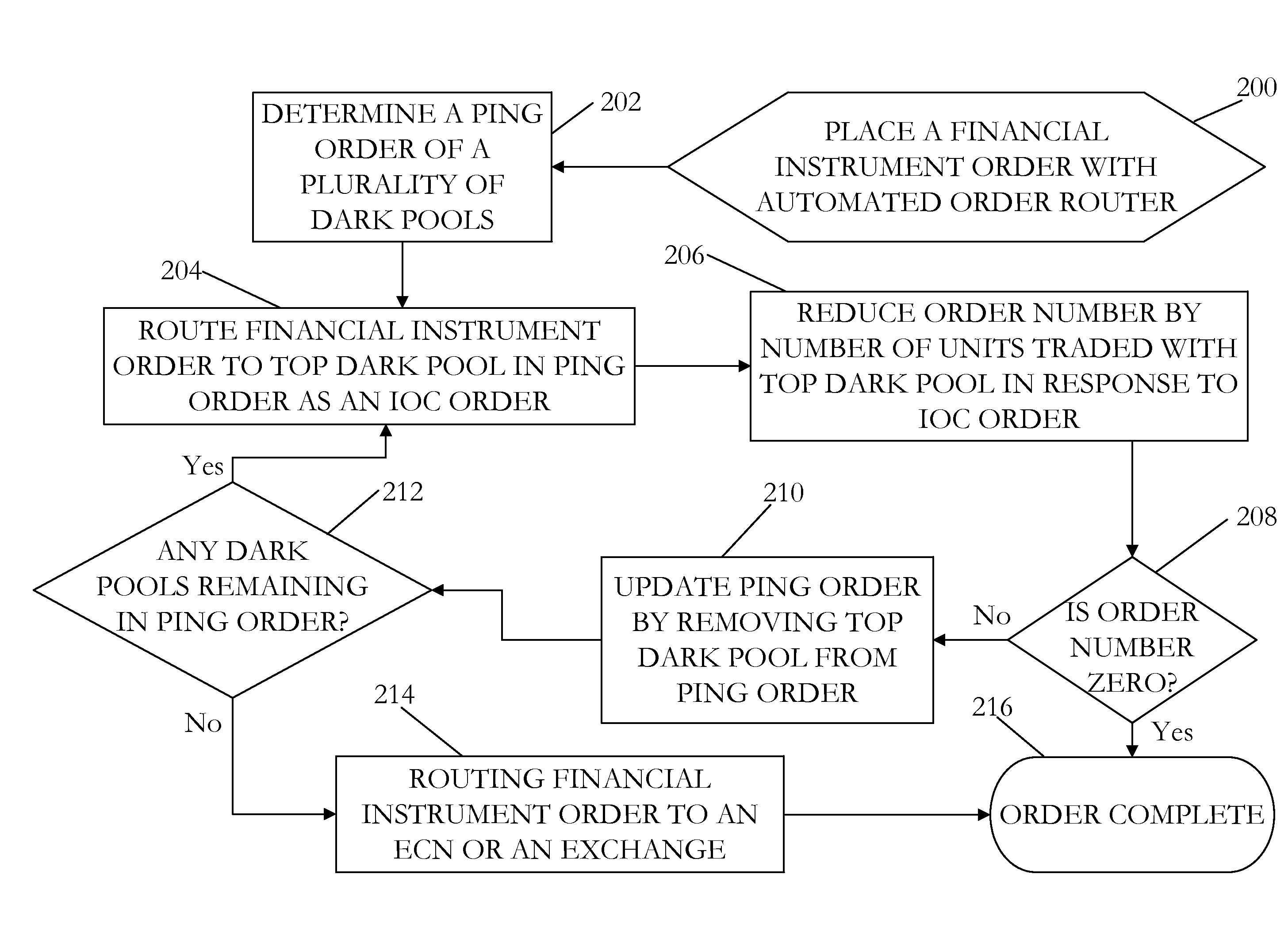

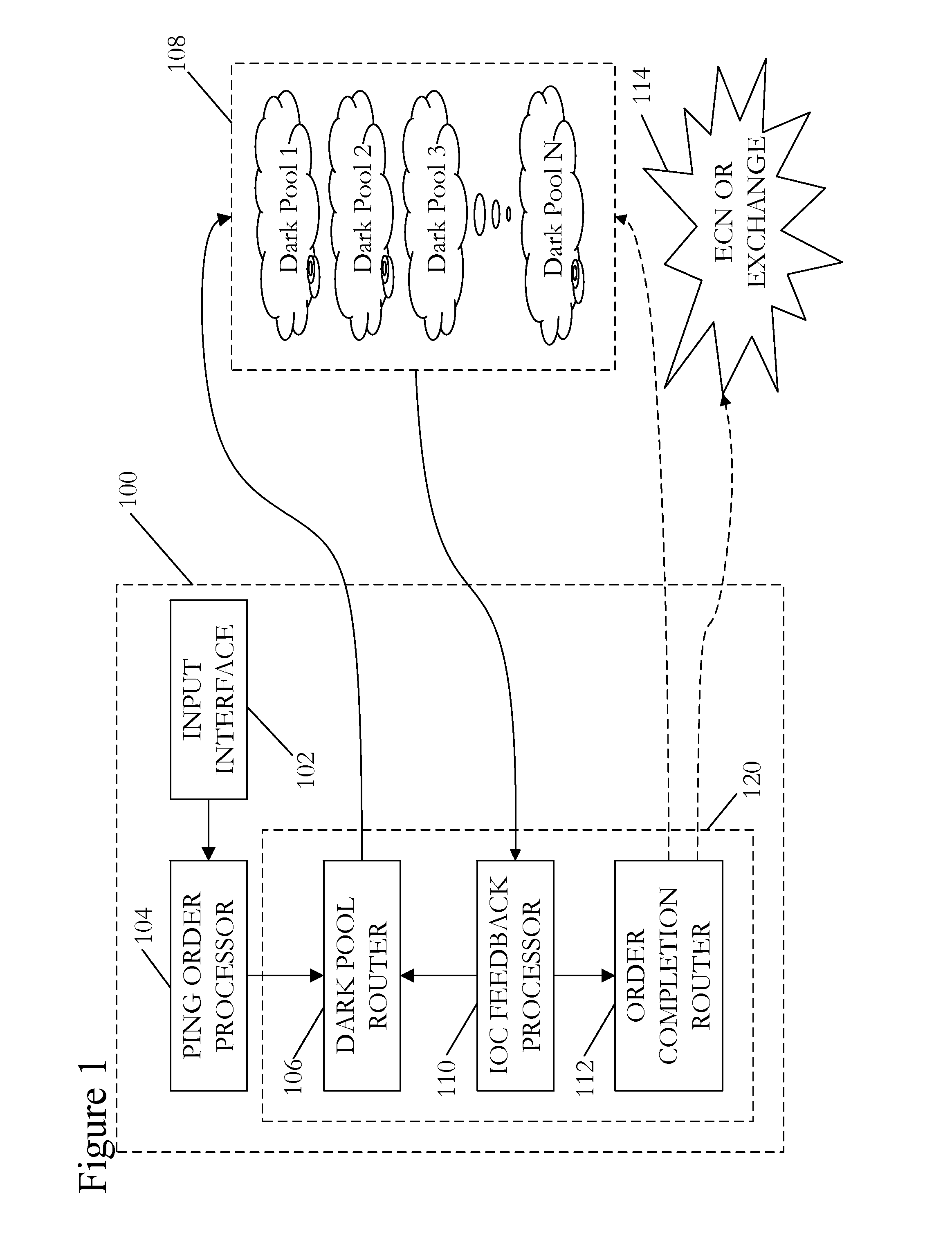

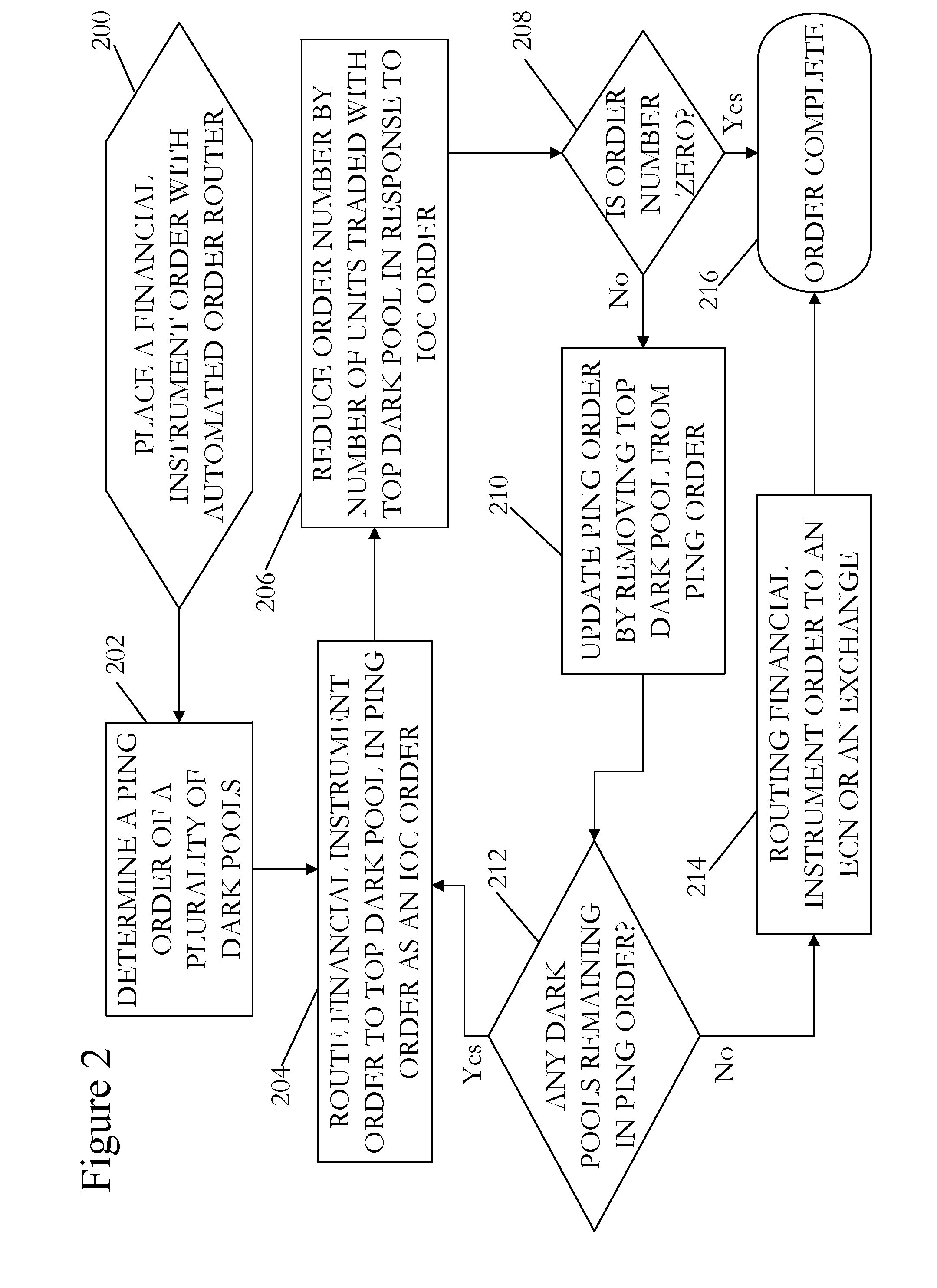

Order routing system and method incorporating dark pools

A method for routing a financial instrument order incorporating dark pools and at least one electronic communication network (ECN) or exchange. The financial instrument order includes an identification of a financial instrument, a bid or ask price, and a number of units to be traded. A ping order of the dark pools is determined. The financial instrument order is routed to a top dark pool as an immediate or cancel order. If the financial instrument order is not complete, the ping order is updated by removing the top dark pool. If any dark pools remain in the updated ping order, the financial instrument order is routed to the next dark pool. This process continues until all of the dark pools have been pinged or the financial instrument order is complete. If the financial instrument order is not complete, the financial instrument order is routed to the ECN or exchange.

Owner:PENSON WORLDWIDE

Systems and methods for biometric identification

InactiveUS20050289079A1FinanceDigital computer detailsElectronic communication networkElectronic transaction

Apparatus and methods for registering biometric information may include receiving the biometric information from an individual; receiving identification information from the individual; and certifying that the identification information identifies the individual. Apparatus and methods for verifying the identity of a participant in an electronic transaction may include receiving over an electronic communication network first physical biometric information derived from the participant; and comparing the first biometric information to second biometric information.

Owner:SHIMON SYST

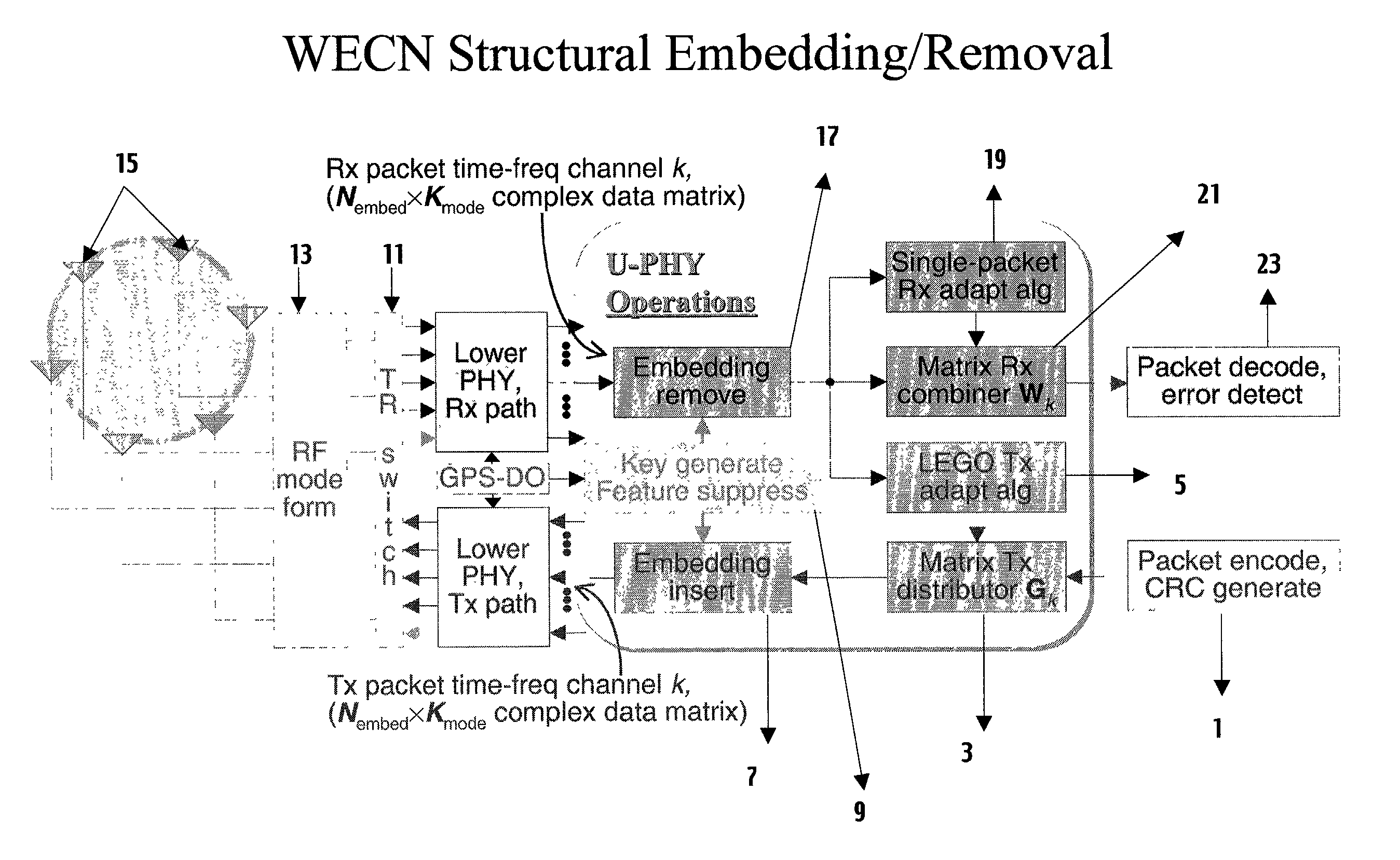

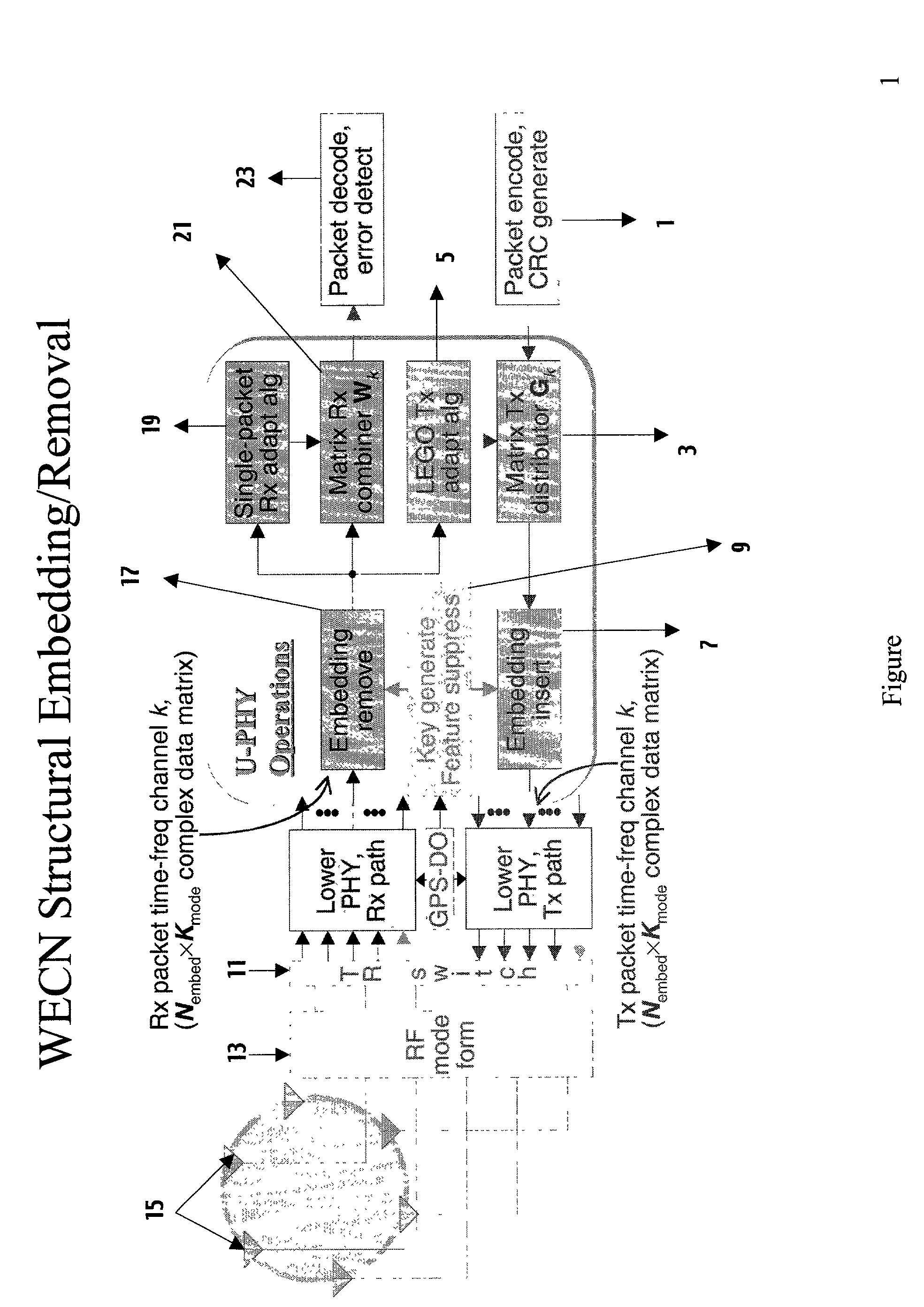

Enhancing security and efficiency of wireless communications through structural embedding

InactiveUS7079480B2Reduce controlReduce status overheadInformation formatTime-division multiplexEnvironmental noiseControl signal

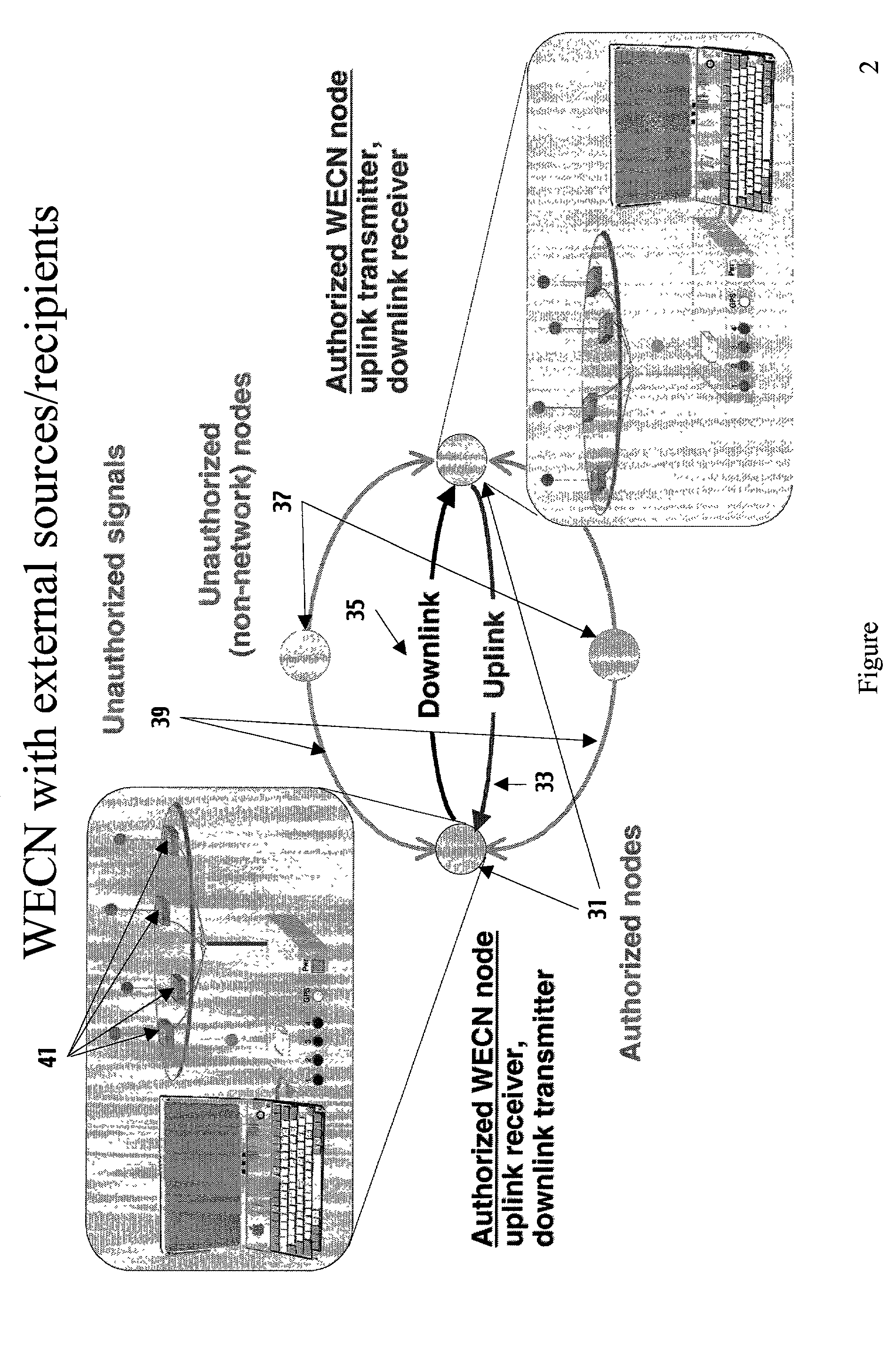

By embedding as a Physical Layer (PHY) Appliqué patterns (time, frequency, tone multiplexed, control signal, explicit network authentication, projective, other, or combined) on wireless electronic communications network (WECN) digital signal packets, and using a QRD-based auto-SCORE adaptation algorithm to maximize the signal-to-interference-and-noise ratio (SINR) attainable by multielement arrays over very small time-bandwidth products, differentiation and detection of signals from environmental noise (particularly from other or non-network signals) can be improved, allowing more compressed, secure, efficient network operations. By projecting the signal embedding onto a known linear subspace and using integrated transmit / receive structures, packet detection algorithms, and blind array adaptation algorithms, the WECN processes the data received with constant false-alarm rate, generalized, maximum-likelihood detectors and multilink signal estimation algorithms, based only on knowledge of the embedding pattern used at the transmit node. The resultant system provides PHY information-assured (PHY-IA) data transmission with improved network efficiency and security.

Owner:COMCAST CABLE COMM LLC

Centrally controllable instant messaging system

ActiveUS7240214B2Improve integrityVerify integrityUser identity/authority verificationUnauthorized memory use protectionSecure communicationPrivate network

A system providing real-time communication over an electronic communication network between two or more users includes a client application associated with each user, a first authentication application having authentication information for at least one user and associated with at least one of the client applications, and a messaging service application maintaining the connection status of all of the users. The first authentication application and the client applications associated with the first authentication application reside on a first private network in communication with a public network. A second authentication application associated with at least one of the client applications and having authentication information for at least one other user reside on a second private network in communication with public network. The authentication applications can receive authentication information from directory services of their private networks. Communication between the authentication applications and the messaging service application is preferably via a secure communications connection.

Owner:R2 SOLUTIONS

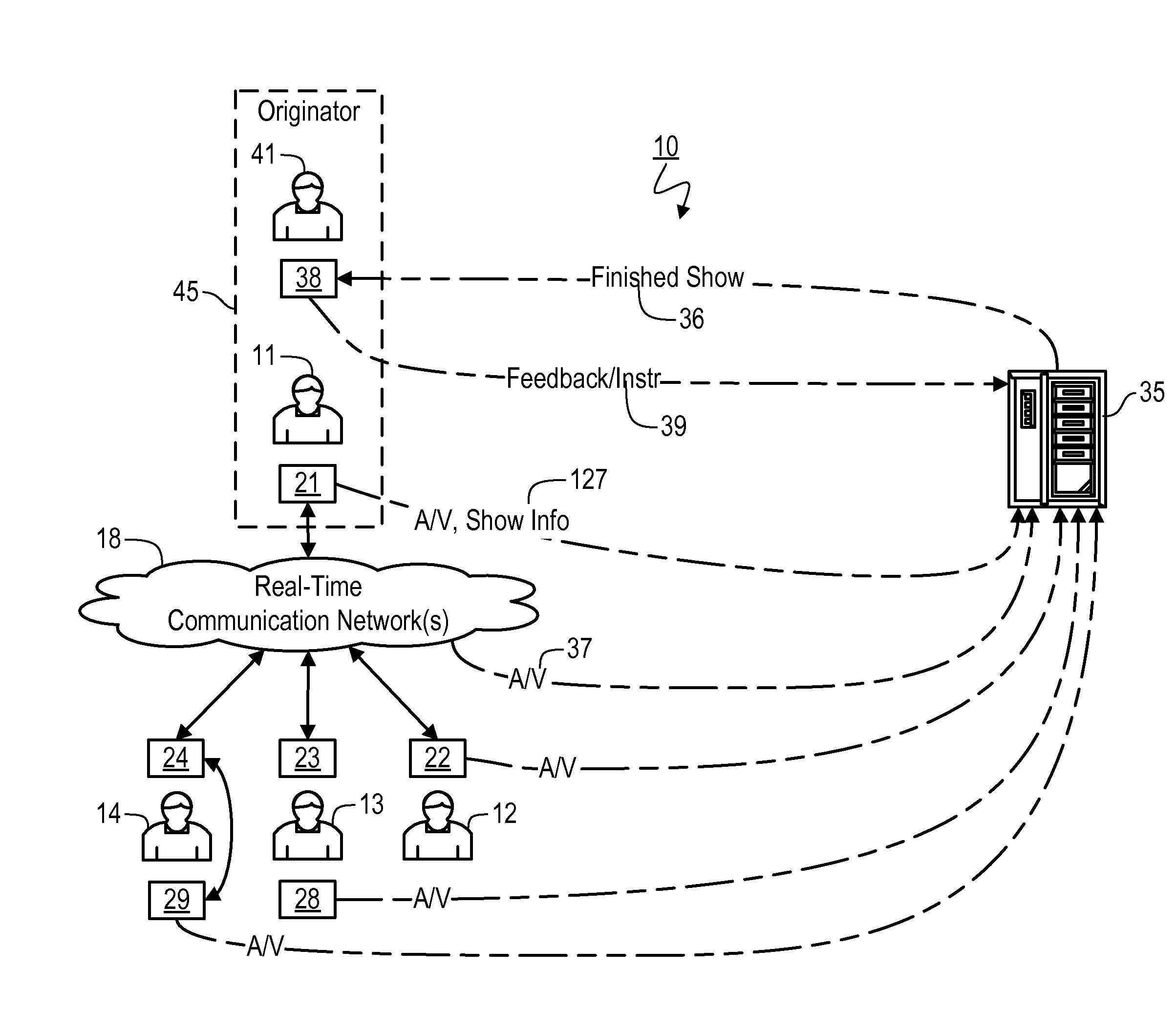

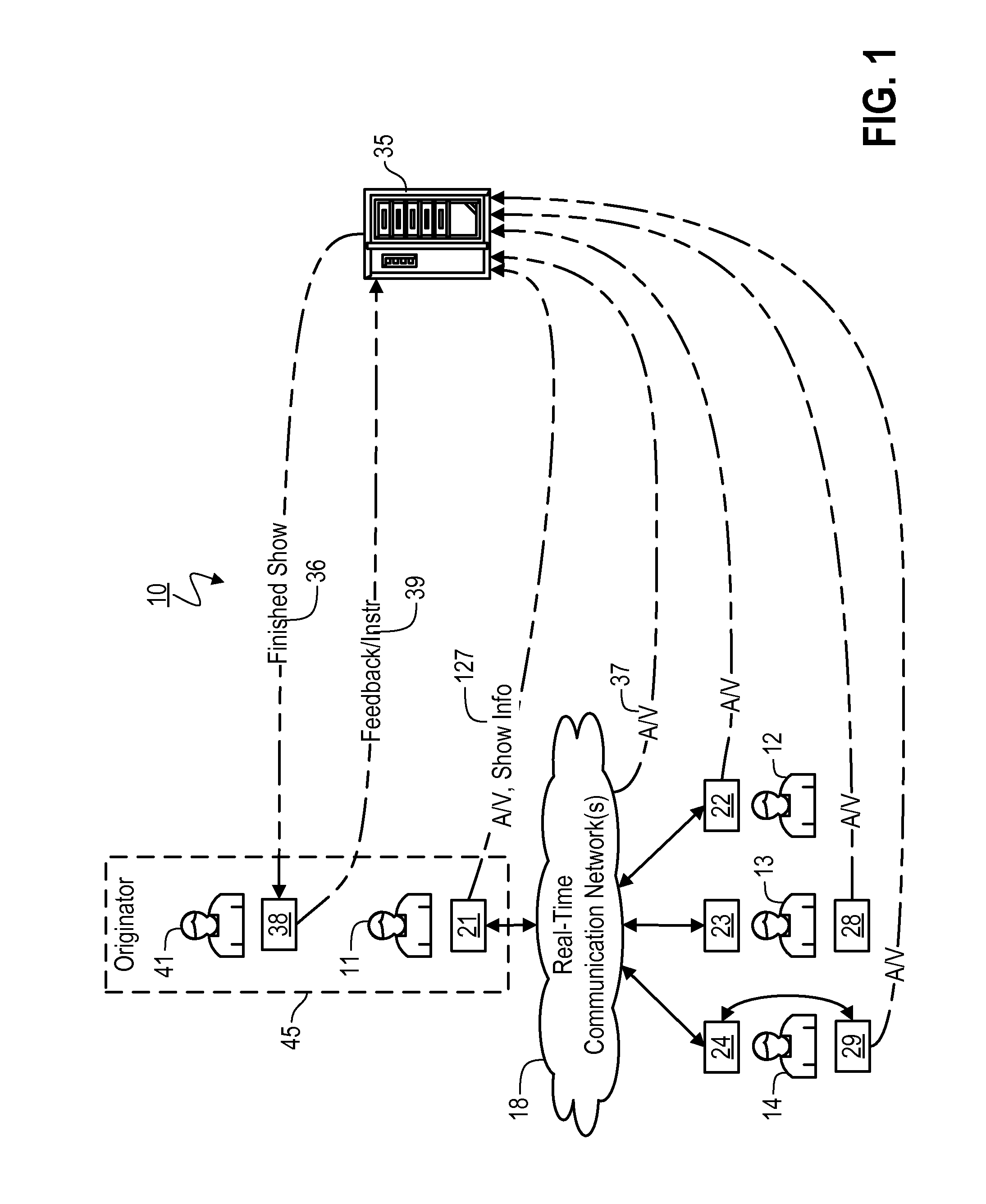

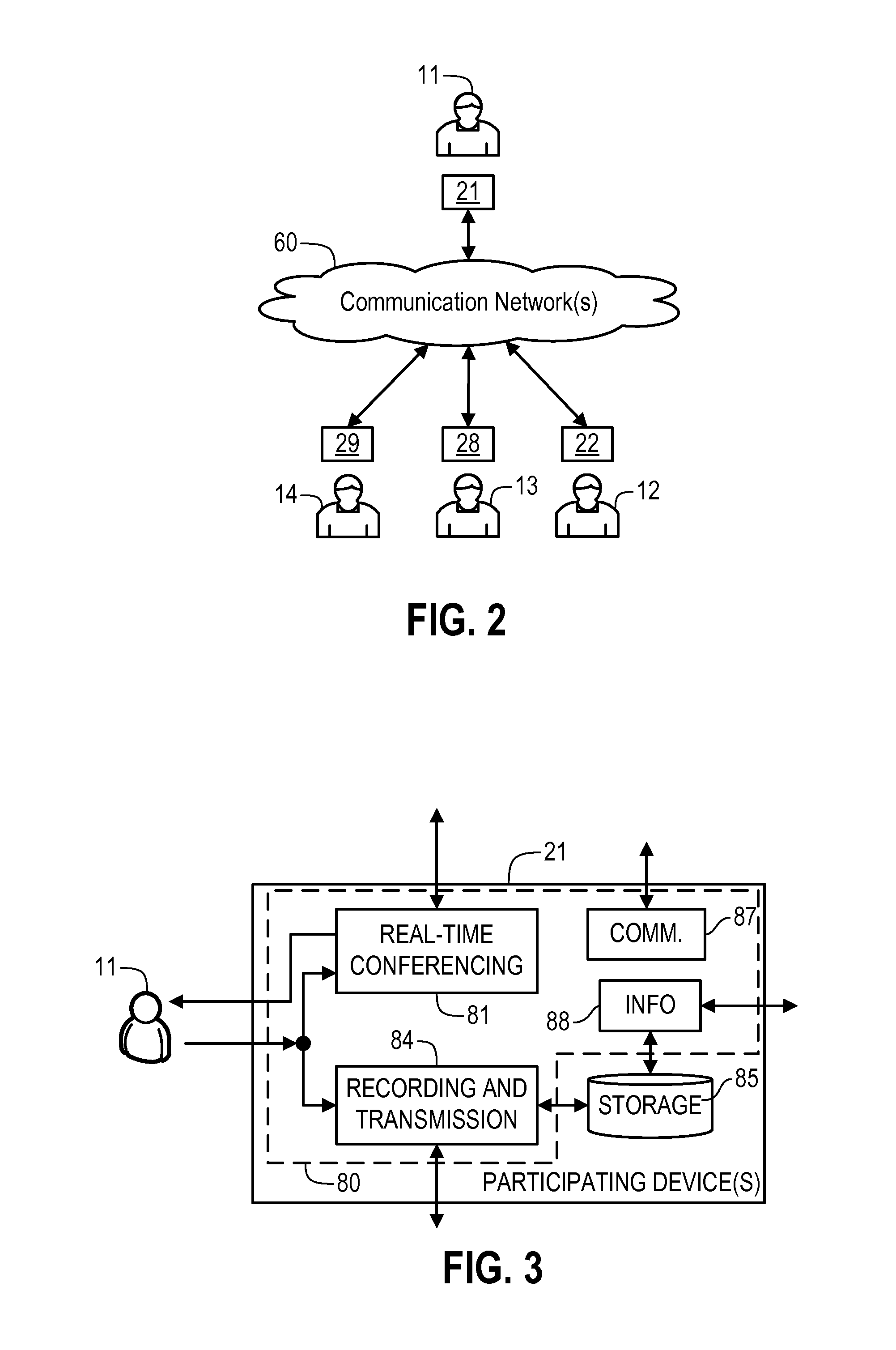

Generation of Composited Video Programming

ActiveUS20110217021A1Television system detailsRecording carrier detailsData streamElectronic communication

Provided are, among other things, systems, methods and techniques for creating a talk shows and other video programming. In one example, a host processor-based facility is configured for: (i) accepting inputs of content and stylistic information for designing a composited video program, (ii); and electronically transferring such content and stylistic information to the processor-based production server; the host processor-based facility and a set of the participant processor-based devices, each associated with a user, are configured: (i) to communicate with each other over an electronic communications network as participating devices in a live conference that includes audio communication, with each of the participating devices transmitting a live first data stream; and (ii) to transmit a second data stream to a processor-based production server; both the first data stream and the second data stream represent a corresponding user's participation in the live conference; and the processor-based production server is configured to receive the second data streams and assemble them into a final composited video program using the content and stylistic information.

Owner:VUMANITY MEDIA +1

System and method for providing and transferring fungible electronic money

A system and method for transferring fungible electronic money is disclosed. The system and method include two or more Central Banks that guarantee the electronic money within an electronic communications network, the electronic money being an authenticated and fungible currency capable of electronic transfer. The system and method further include registering a first user within the electronic services network, registering a second user within the electronic services network, receiving a request from the first user to transfer at least a portion of the electronic money to the second user, and electronically transferring the at least a portion of the electronic money to a mobile device belonging to the second user in response to the request received from the first user, wherein the electronic transfer occurs within the electronic communications network.

Owner:GIORI ROBERTO

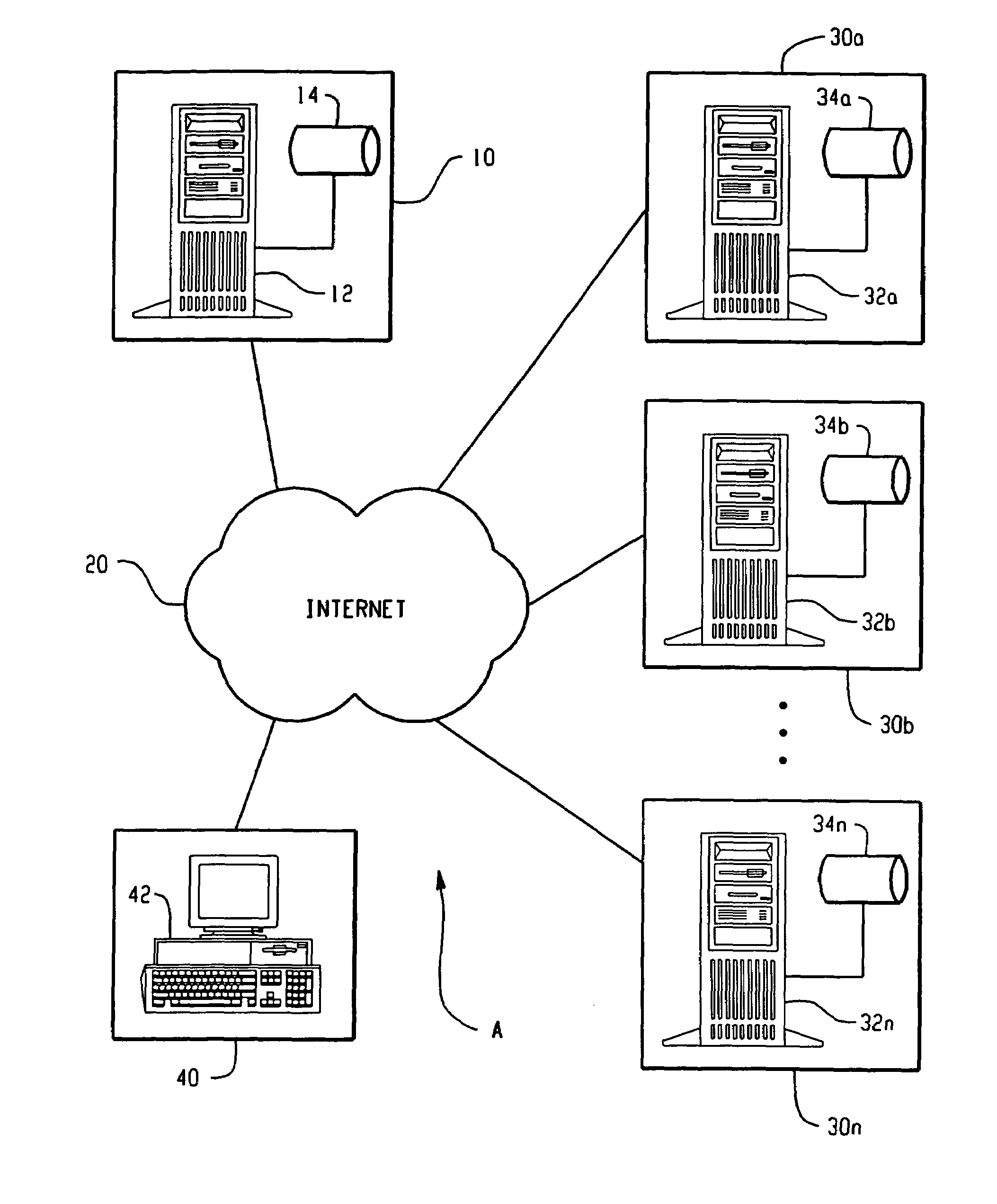

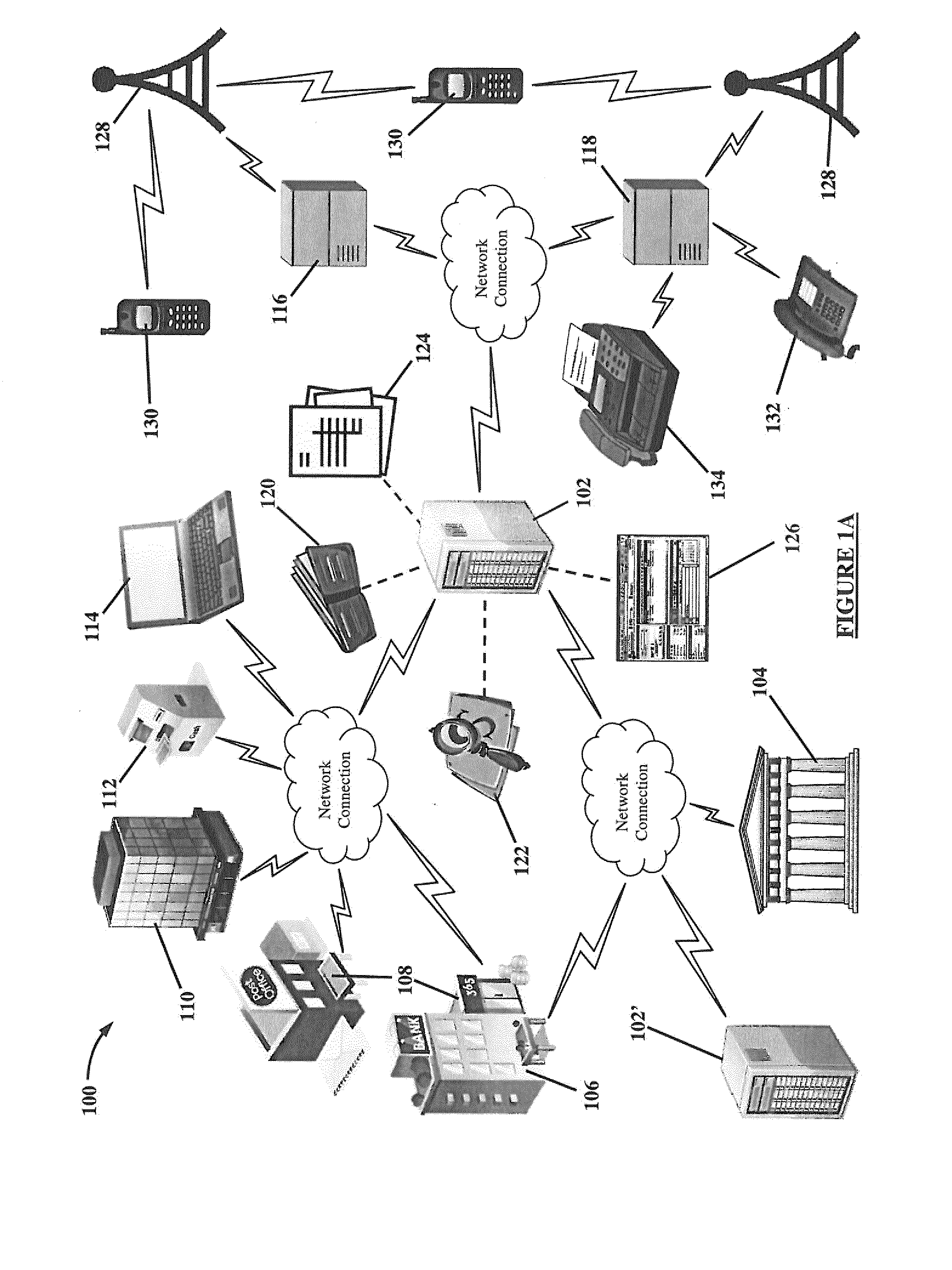

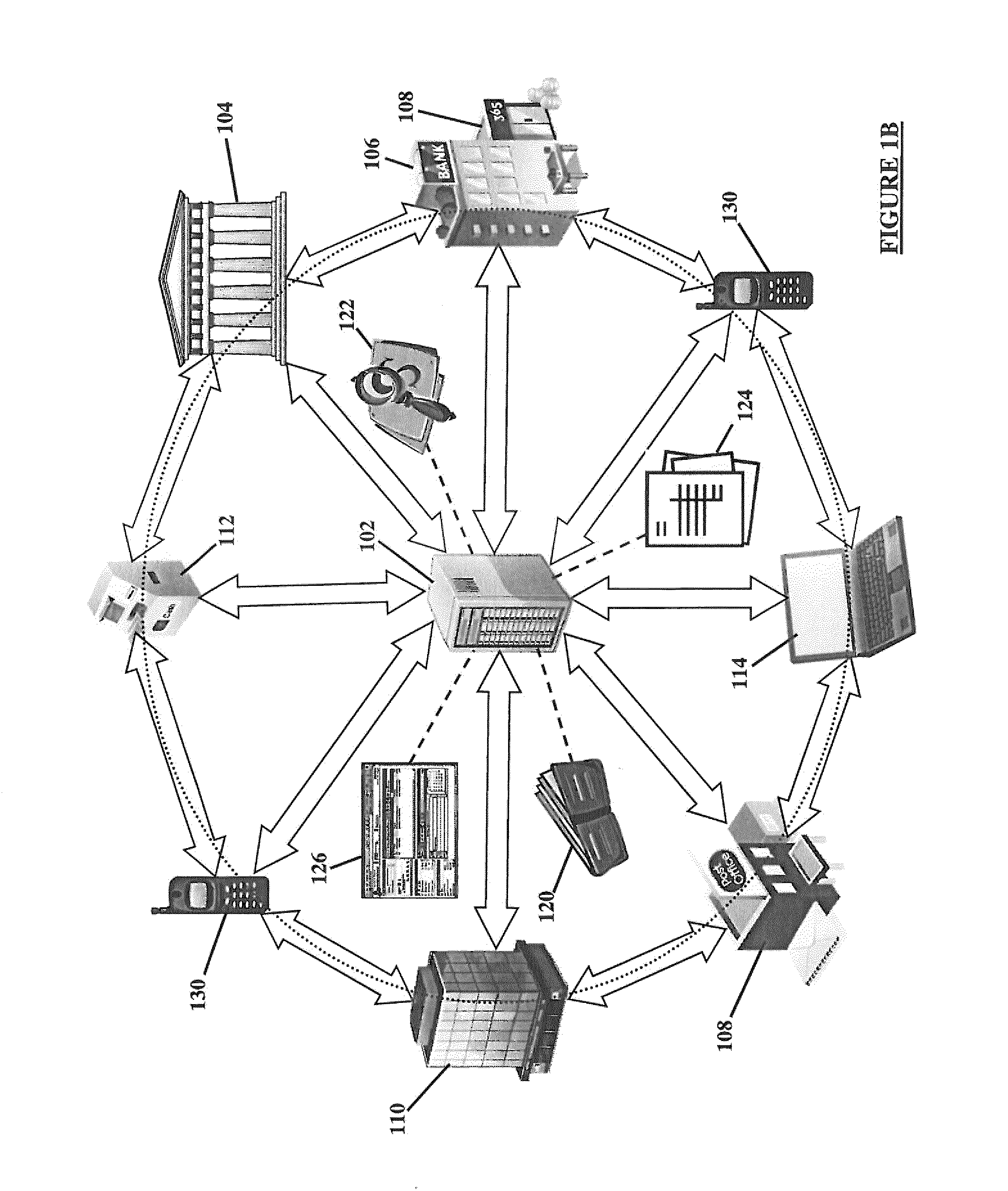

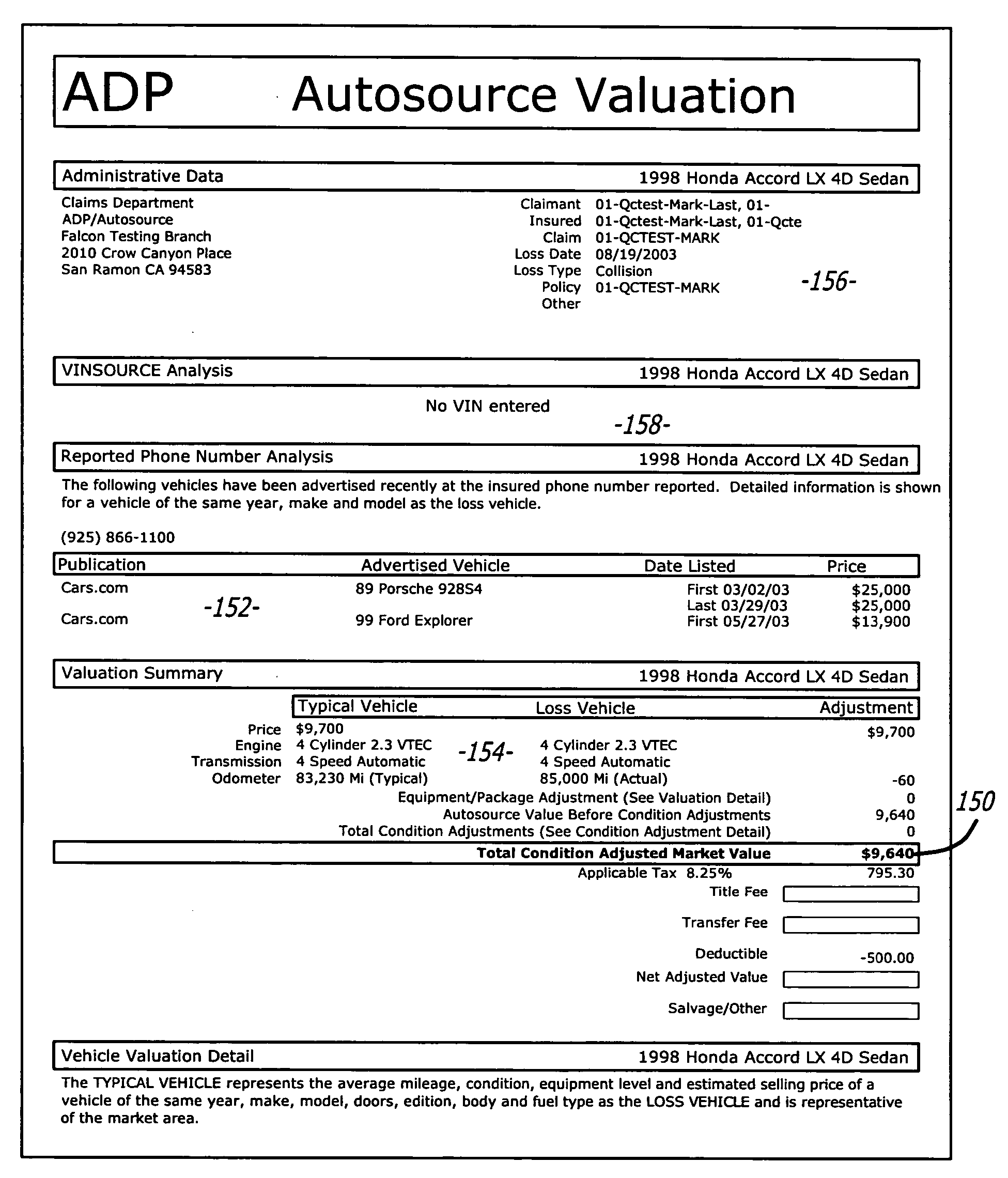

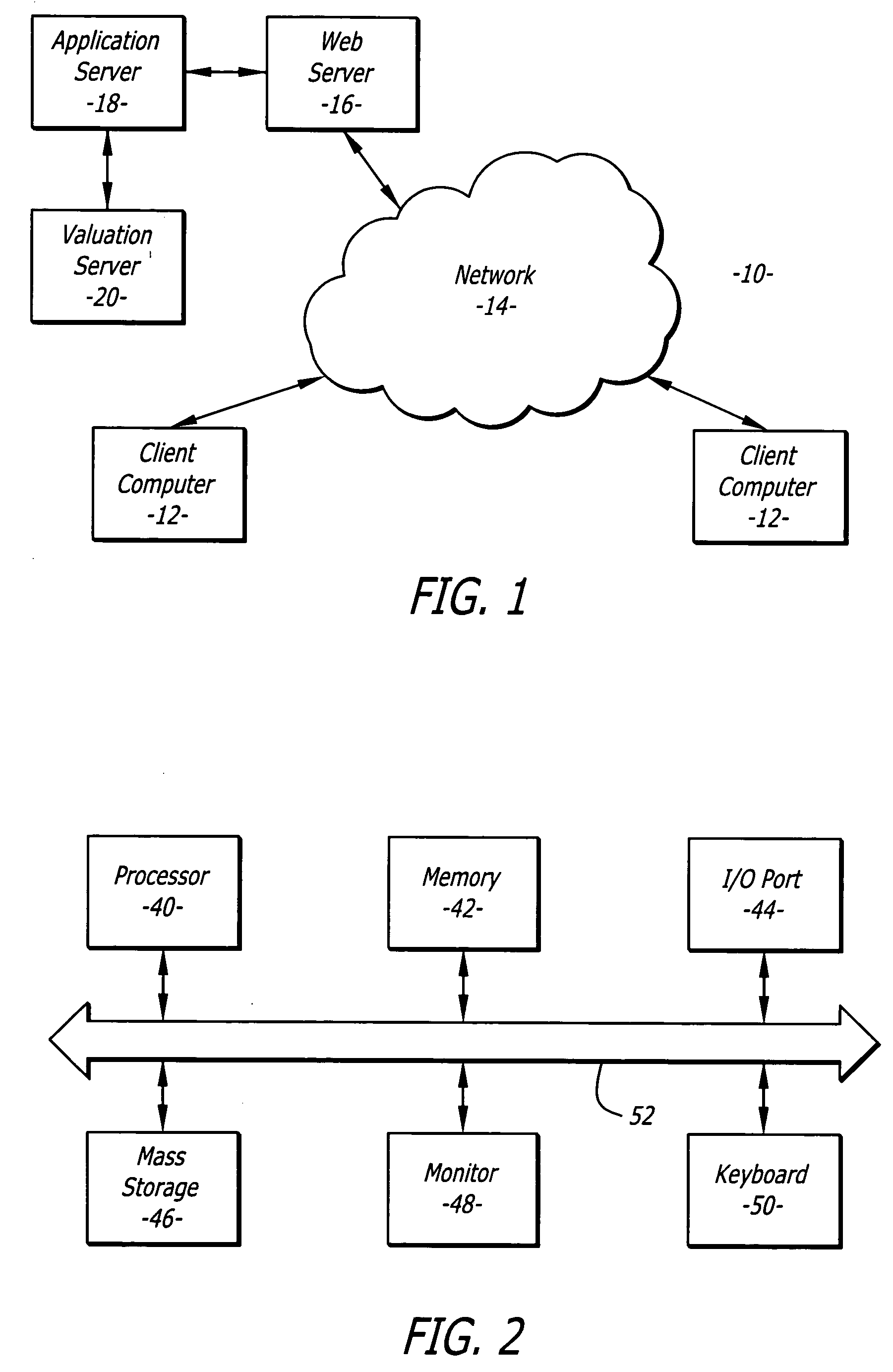

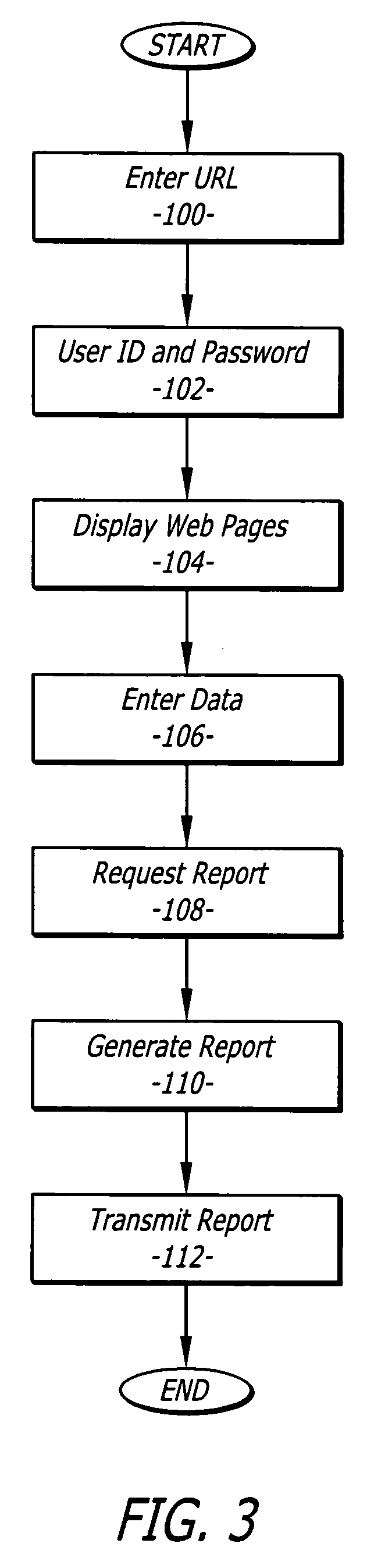

System and method for processing work products for vehicles via the world wide web

A method and system for receiving data relating to an insurance claim for a damaged vehicle and transmitting a valuation report for the damaged vehicle over the world wide web. The system includes a client computer and a web server that are coupled through an electronic communication network such as the internet. The web server contains a web site that contains a plurality of web pages. Each web page allows an operator to enter the insurance claim data. The data can be processed into a valuation report by a separate valuation server. The valuation report can be transmitted to the client computer through the web server. A claims adjuster can access the web server by merely entering a uniform resource locator (“URL”) into a web browser. The adjuster does not have to dial directly into the valuation server.

Owner:AUDATEX NORTH AMERICA LLC

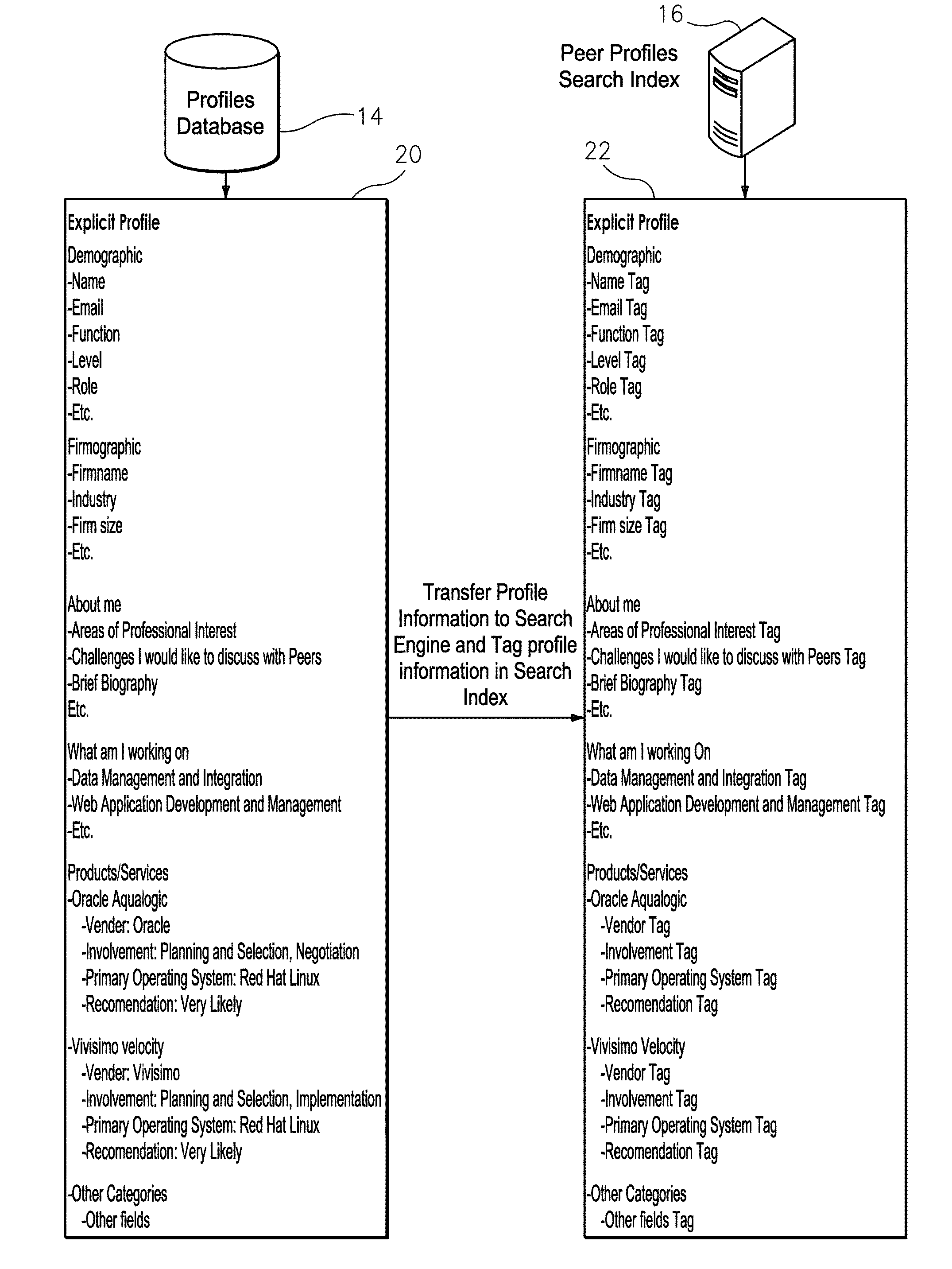

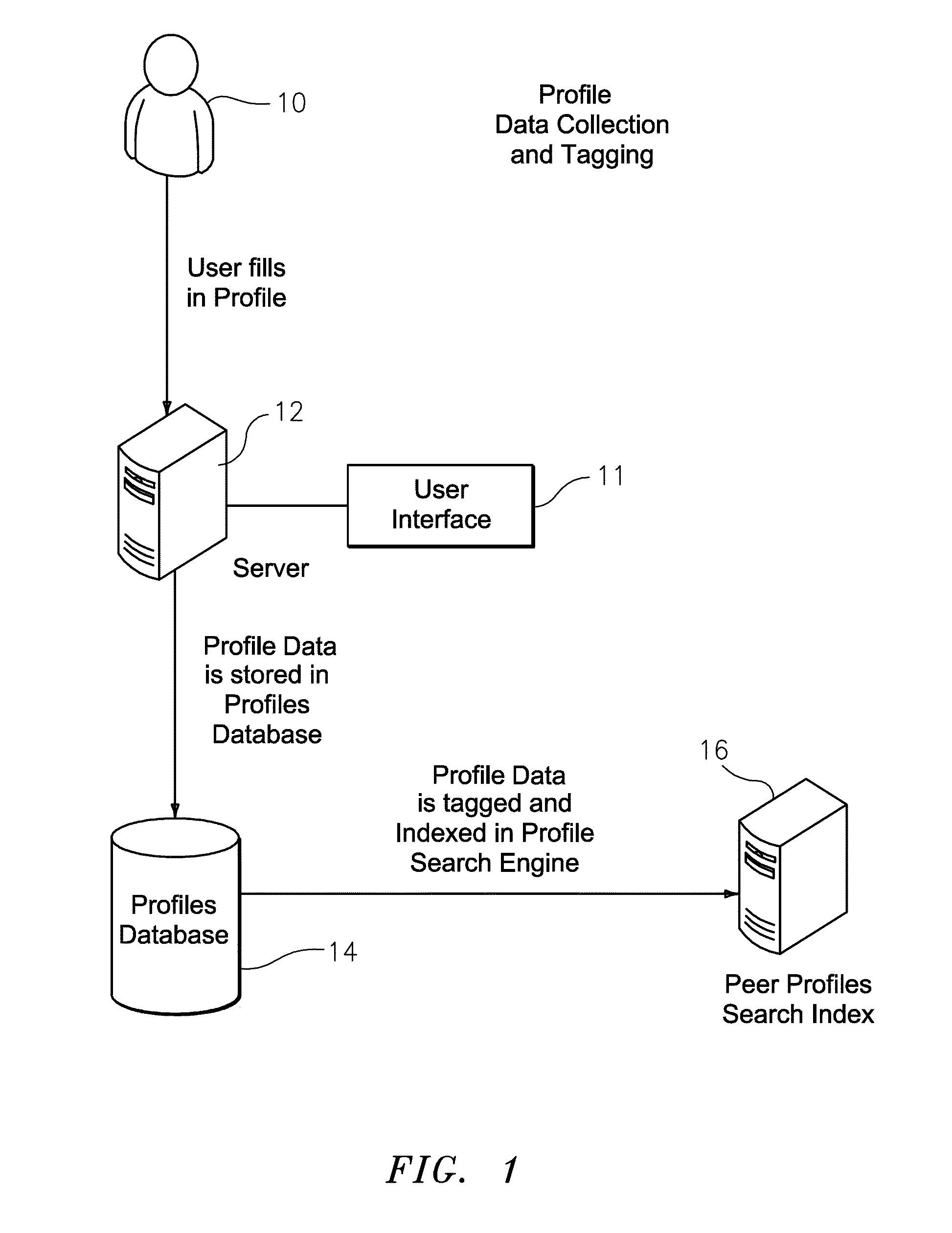

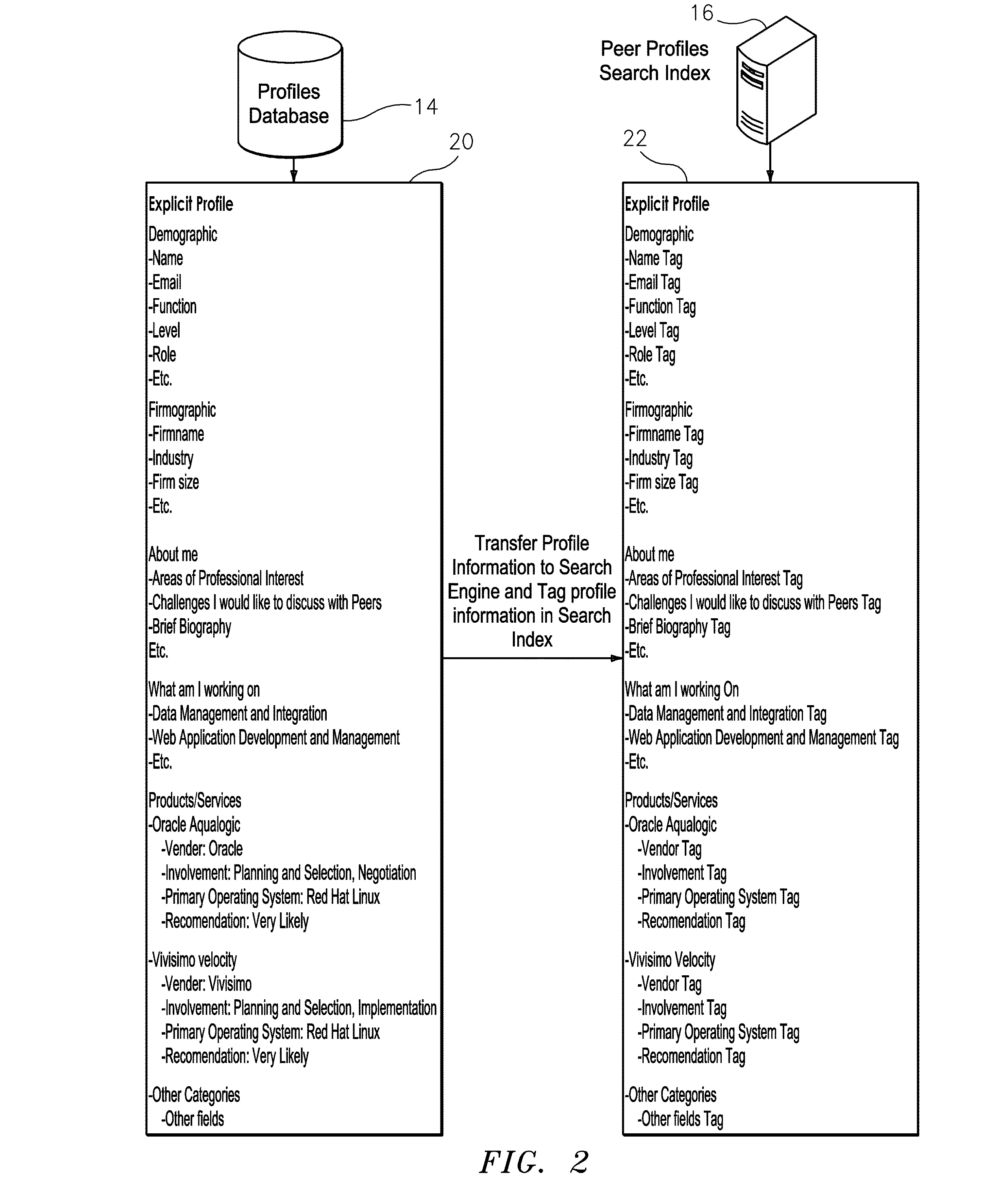

Implicit profile for use with recommendation engine and/or question router

ActiveUS20150058380A1Improve response rateIncrease question rateDatabase queryingDigital data processing detailsSkill setsElectronic communication network

Methods and systems for creating an implicit profile for use by a recommendation engine or a question router is provided. User behavior on at least one of one or more electronic devices and an electronic communications network is tracked. User-related information relating to the user behavior is analyzed to extract or derive key words therefrom. The key words are stored in a profiles database as the implicit profile and used by the recommendation engine or question router to characterize user interests, expertise, and skills when matching a request from a querying user to a potential user or group of users having the relevant background to respond to the request.

Owner:GARTNER INC

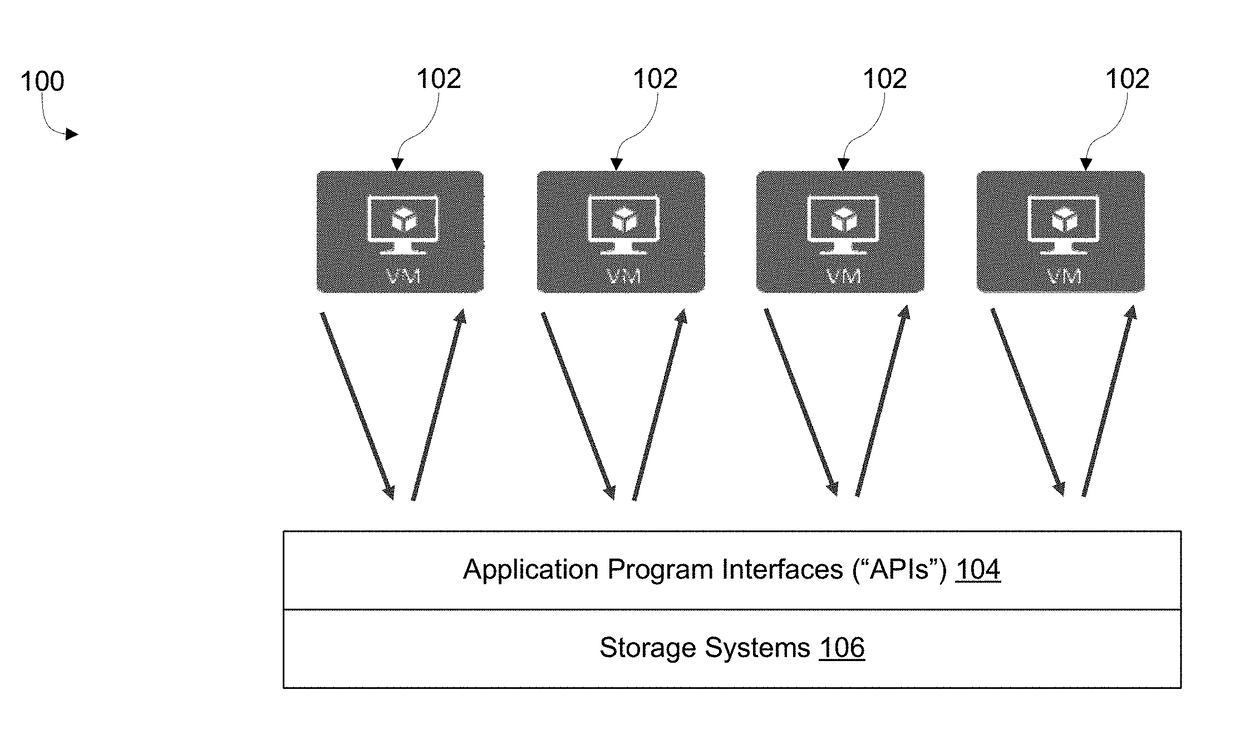

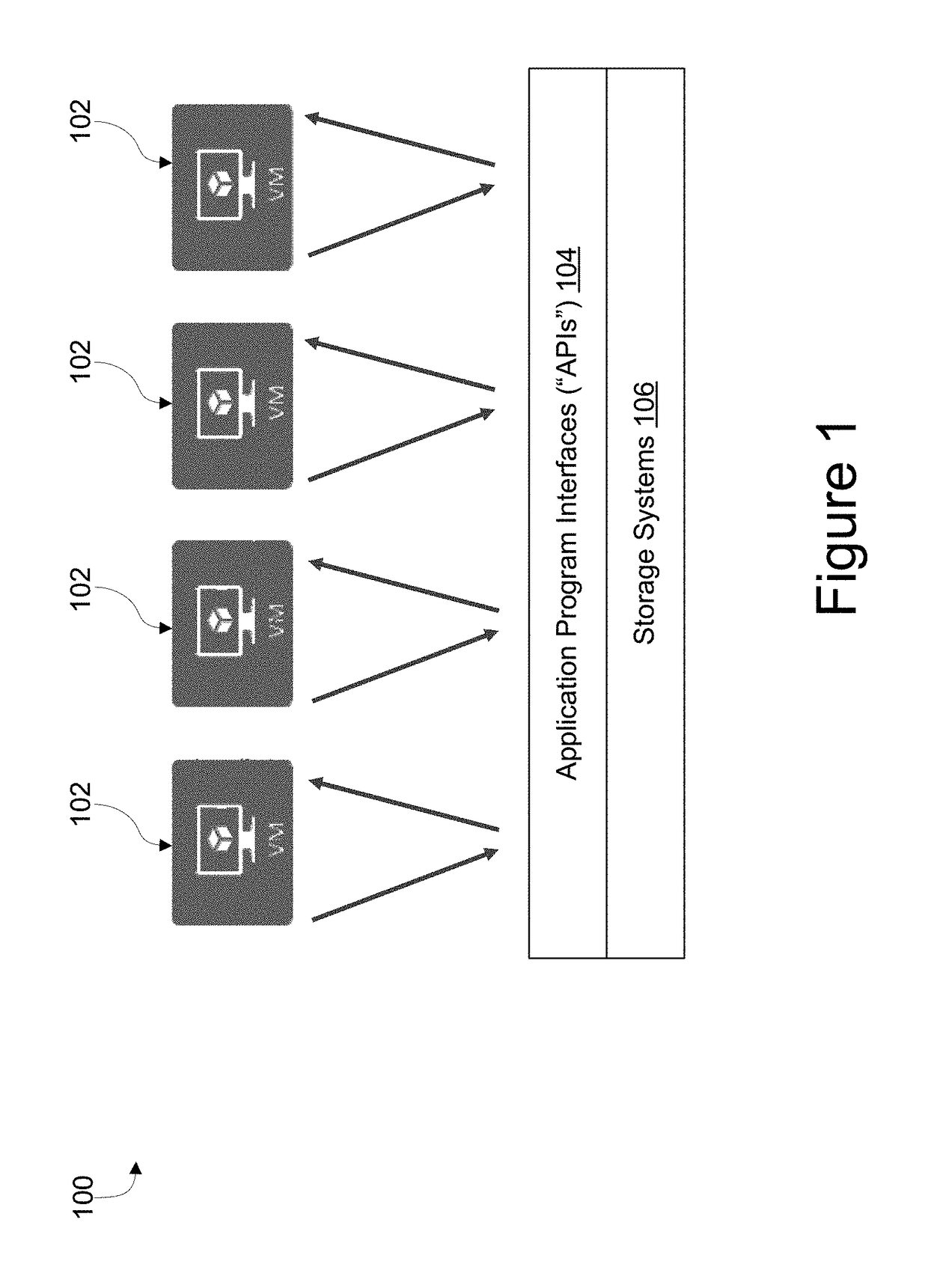

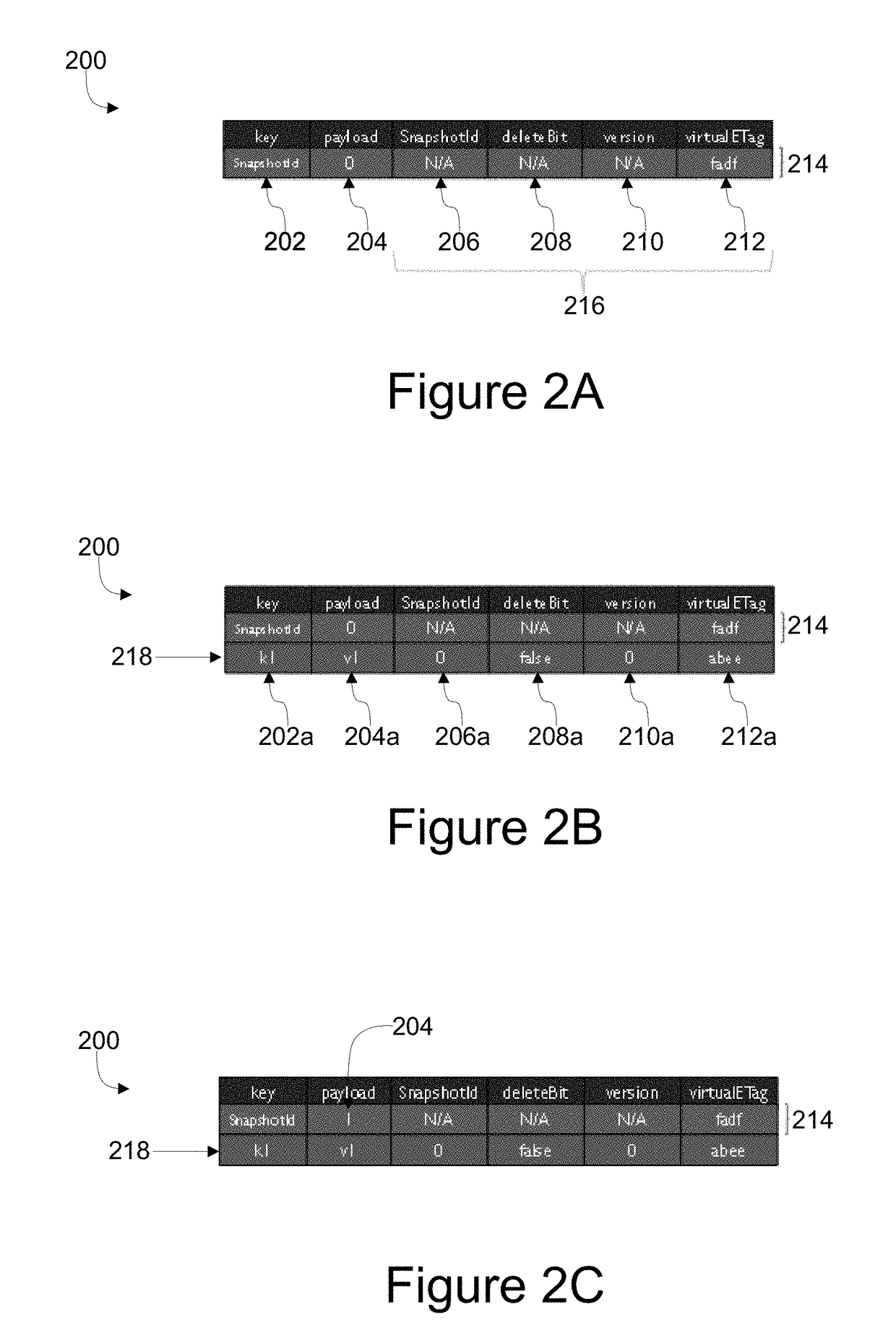

Systems, methods, and computer-readable media for a fast snapshot of application data in storage

ActiveUS20180218000A1Database modelsSpecial data processing applicationsElectronic communication networkDatabase

Techniques for a fast snapshot of application data in a storage system are disclosed. One computer-implemented method includes: receiving, over an electronic communications network, a first command to create a table; creating, in a storage system, the table including at least one row and a plurality of columns, the at least one row including a special metadata row, and fields of the plurality of columns including a key, a payload, a snapshot identifier number, a delete bit, a version identifier, and an entity tag; and initializing a key of the special metadata row and a payload of the special metadata row. The key of the special metadata row is initialized to a snapshot identifier, and the payload of the special metadata row is initialized to zero, and an entity tag of the special metadata row is initialized to a random value.

Owner:MICROSOFT TECH LICENSING LLC

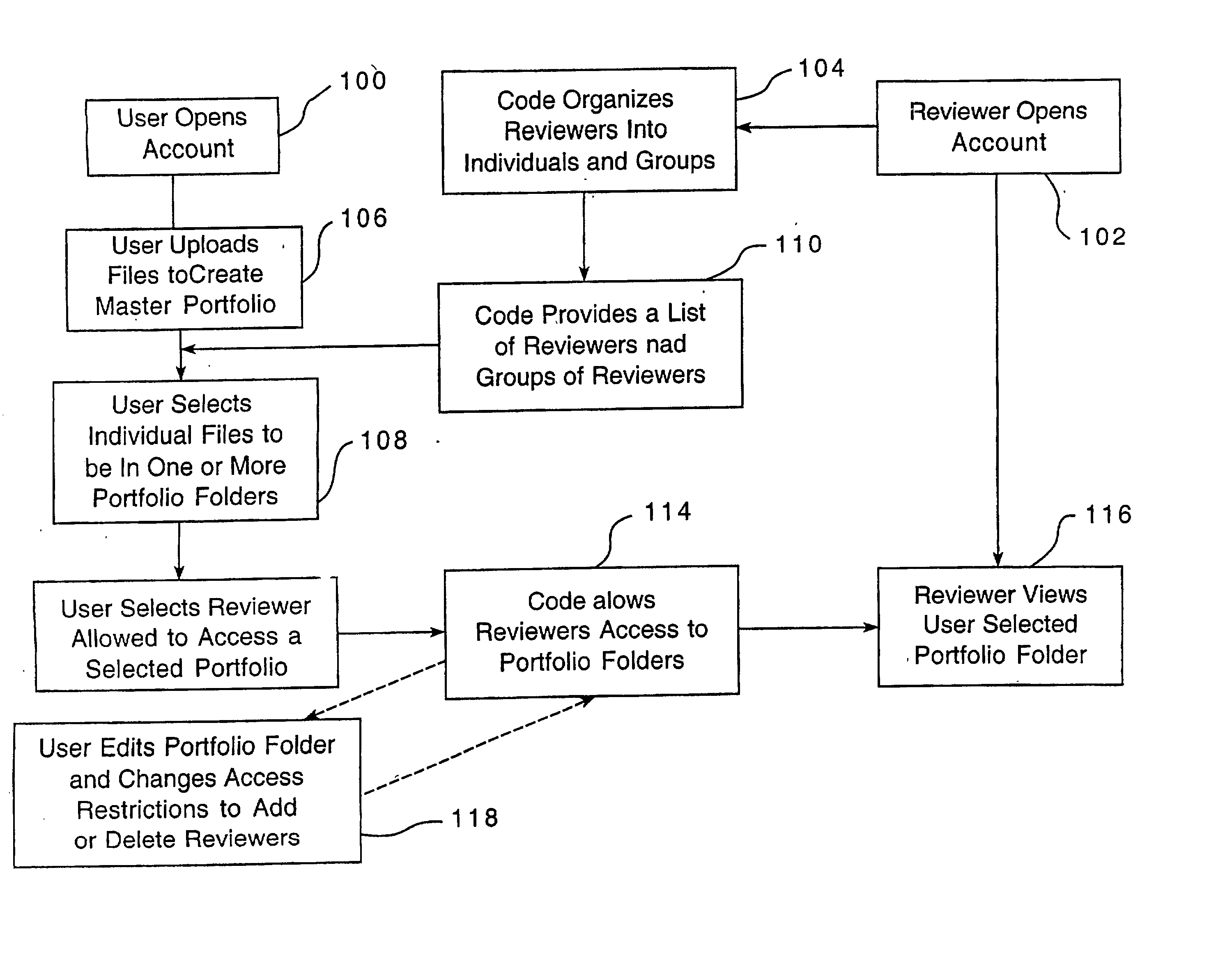

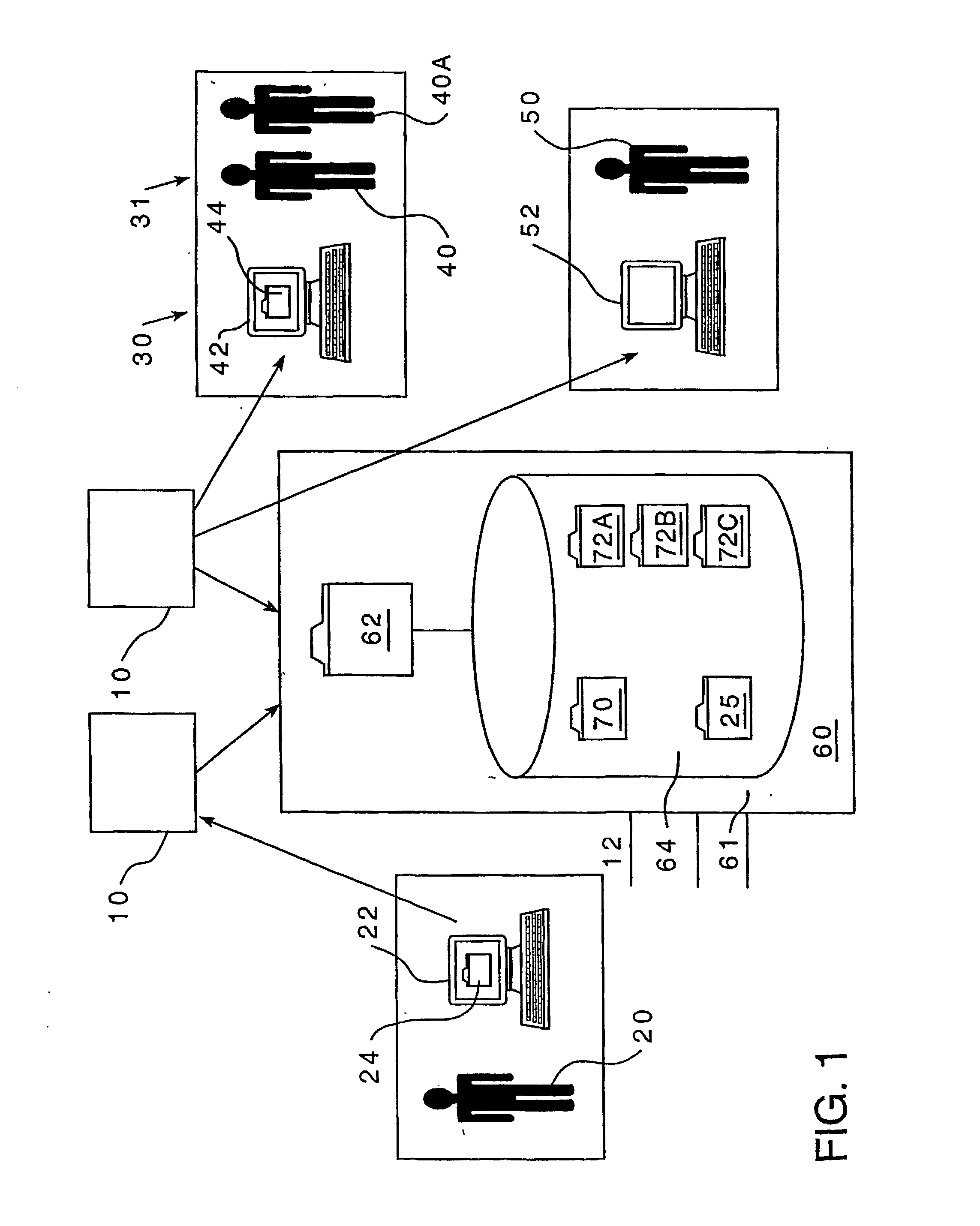

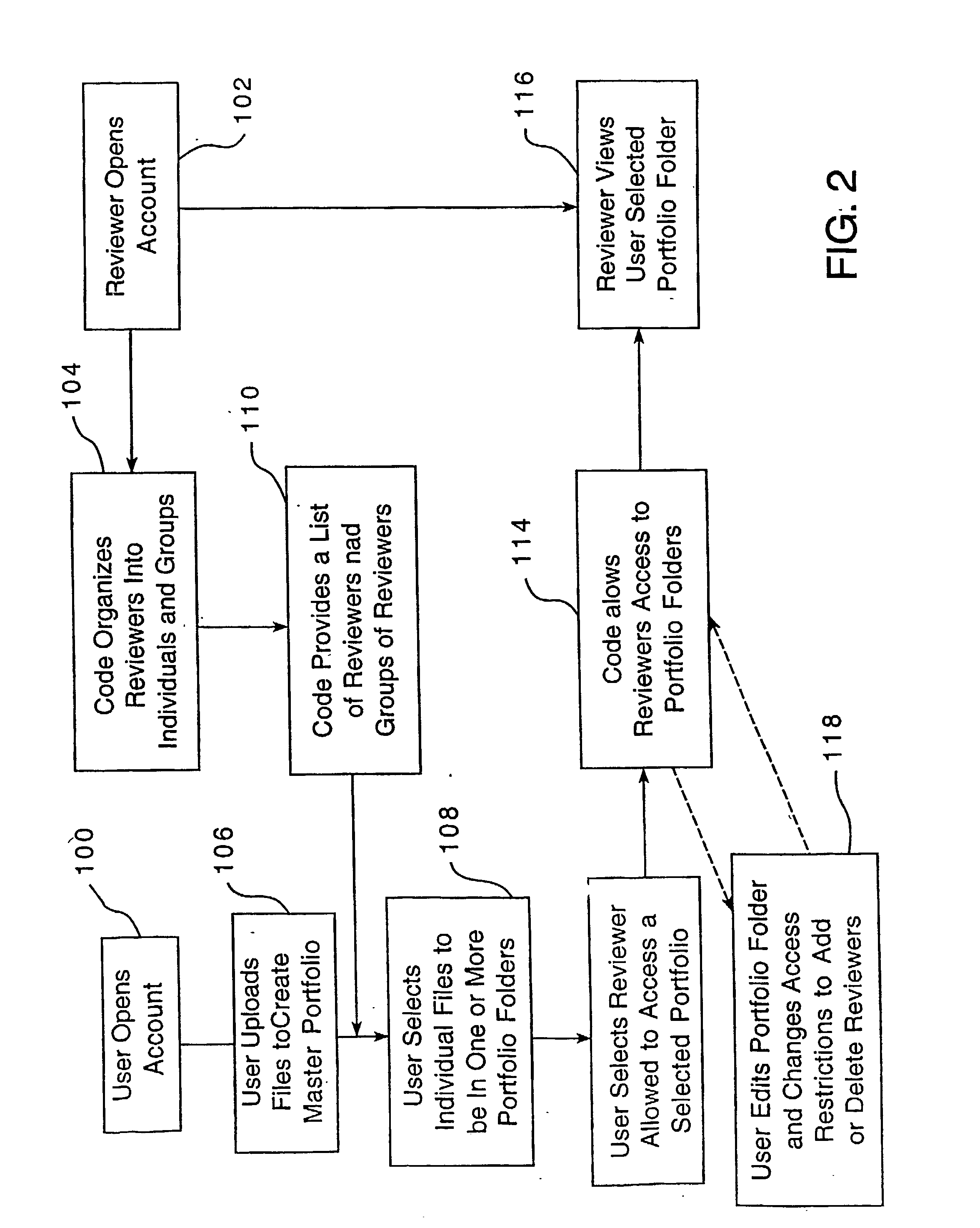

Computerized portfolio and assessment system

A method that is operative with a computer executable code to create a selectively accessible and user controlled portfolio folder. The method, which is a computer implemented method for sharing personal information through an electronic communication network between a user and one or more reviewers, includes the steps of: providing an electronic storage medium having a computer executable code for creating and viewing a selectively accessible electronic portfolio folder, establishing accounts for the users and the reviewers, allowing the user access to the computer executable code through the electronic communication network, allowing the user to create and / or edit one or more portfolio folders and place content in the portfolio folders, allowing the one or more reviewers access to the computer executable code through the electronic communication network, and allowing the one or more reviewrs to view the portfolio folders selected by the user.

Owner:NUVENTIVE LLC

Order routing system and method incorporating dark pools

A method for routing a financial instrument order incorporating dark pools and at least one electronic communication network (ECN) or exchange. The financial instrument order includes an identification of a financial instrument, a bid or ask price, and a number of units to be traded. A ping order of the dark pools is determined. The financial instrument order is routed to a top dark pool as an immediate or cancel order. If the financial instrument order is not complete, the ping order is updated by removing the top dark pool. If any dark pools remain in the updated ping order, the financial instrument order is routed to the next dark pool. This process continues until all of the dark pools have been pinged or the financial instrument order is complete. If the financial instrument order is not complete, the financial instrument order is routed to the ECN or exchange.

Owner:PENSON WORLDWIDE

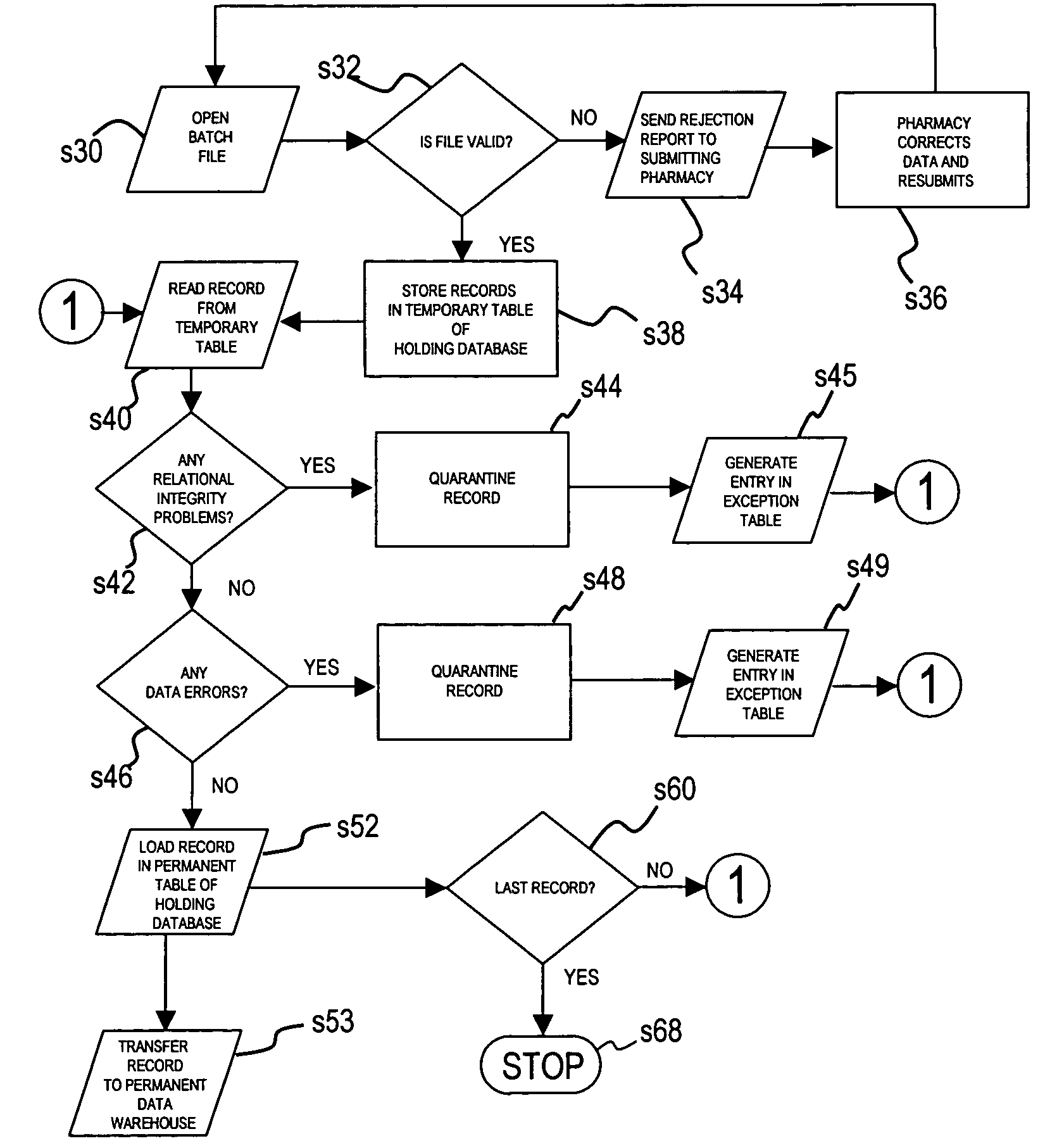

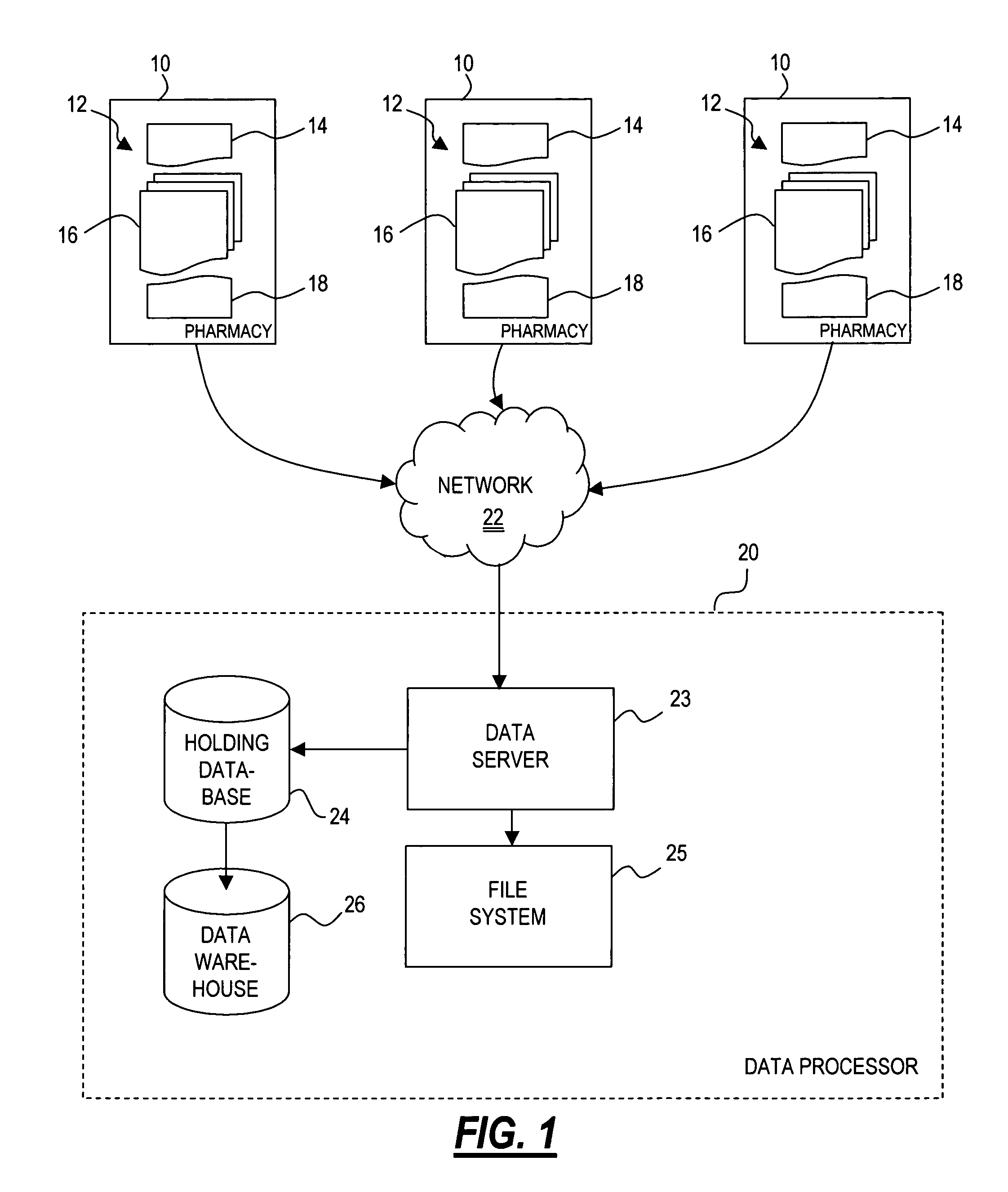

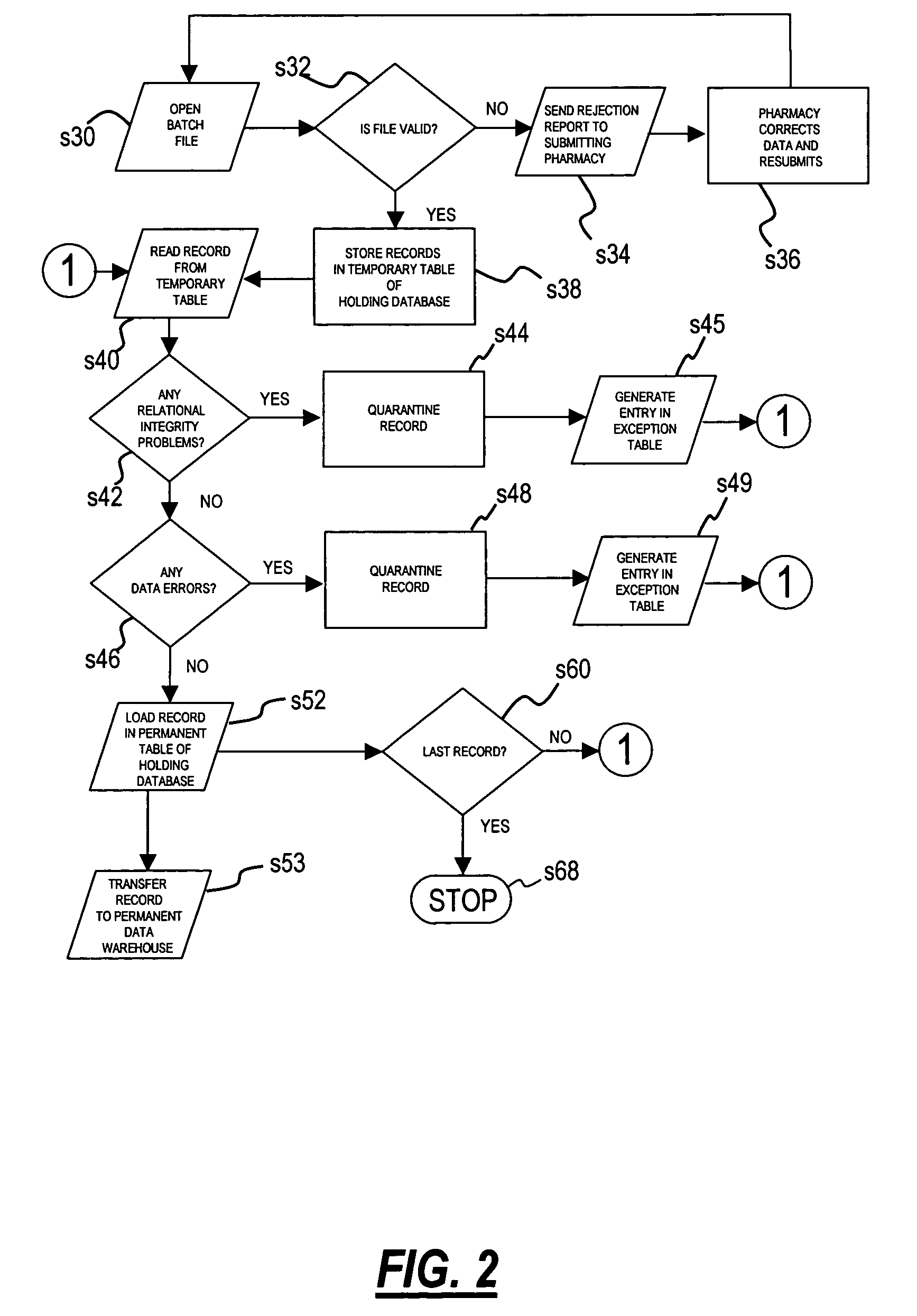

Method for processing and organizing pharmacy data

A method for processing and organizing pharmaceutical data from a plurality of sources. Batch files are submitted to a data processor electronically, such as via an electronic communications network. The batch files are checked for validity, then stored in a holding database. Records are read from the batch file and checked for errors such as relational integrity. Records having errors are noted in an exception file and held for correction, while records having no defects are placed into a common format and loaded into a data warehouse. Records having minor defects may also be loaded into the data warehouse pending correction of the defects.

Owner:OMNICARE INC

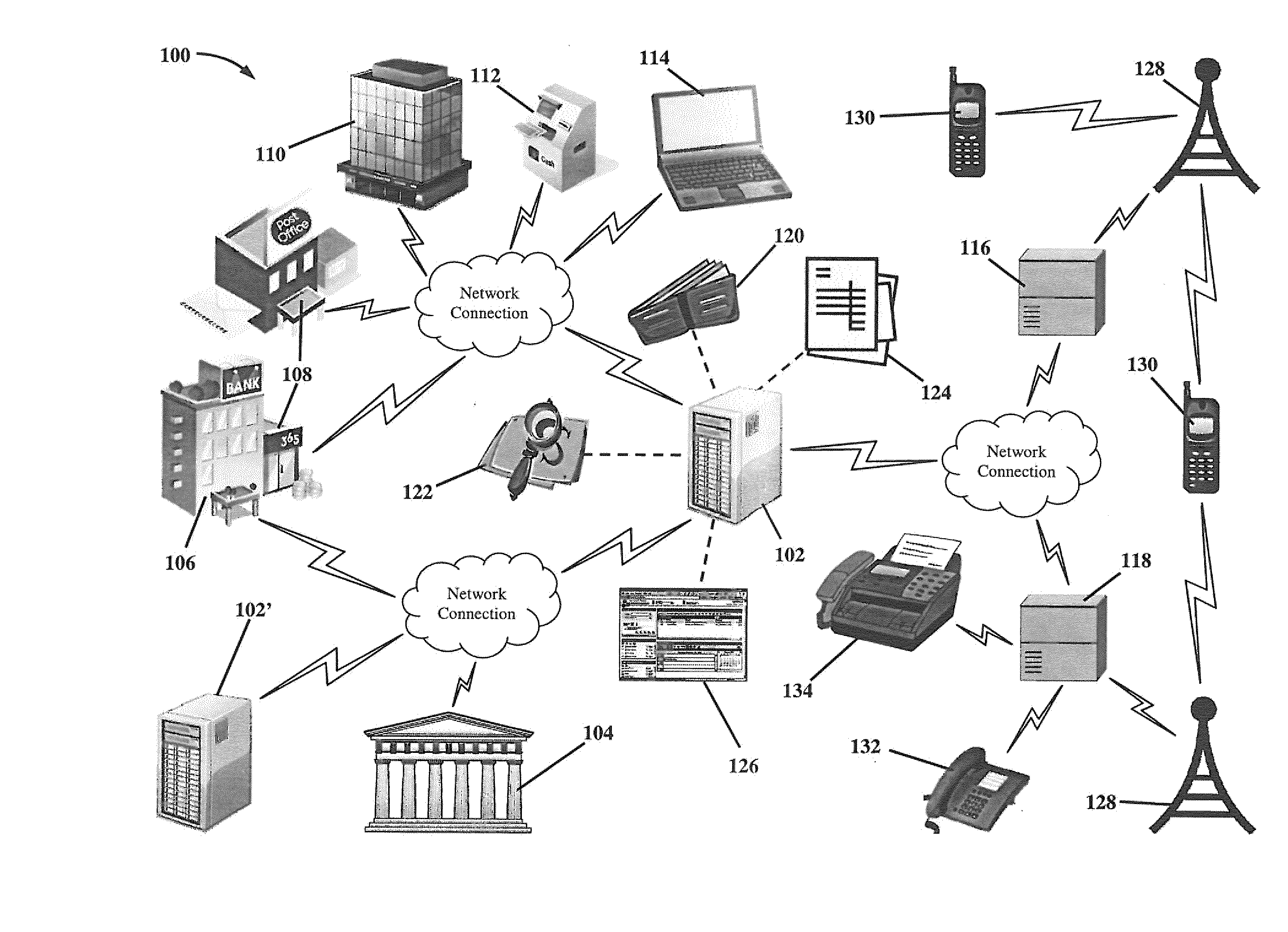

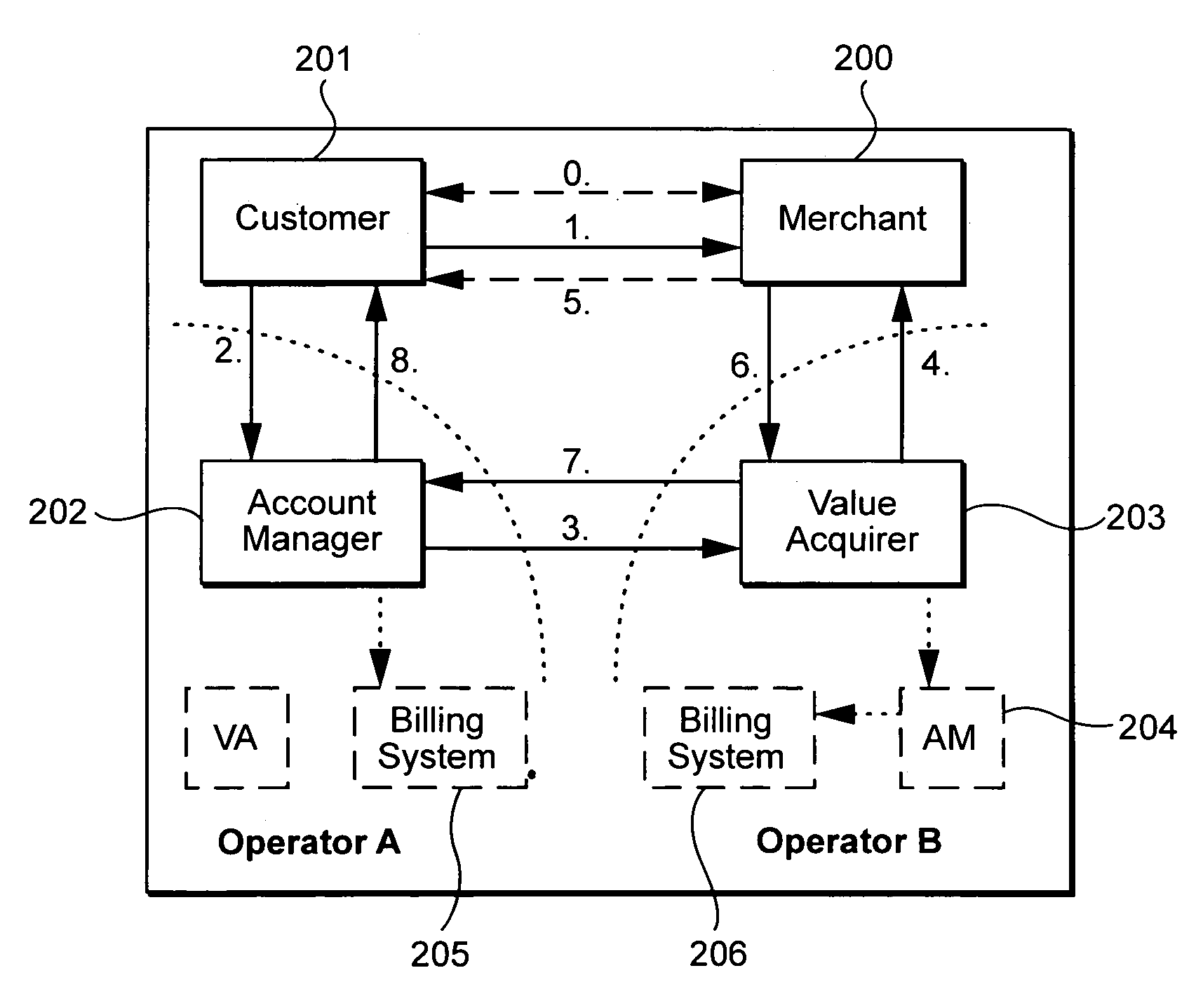

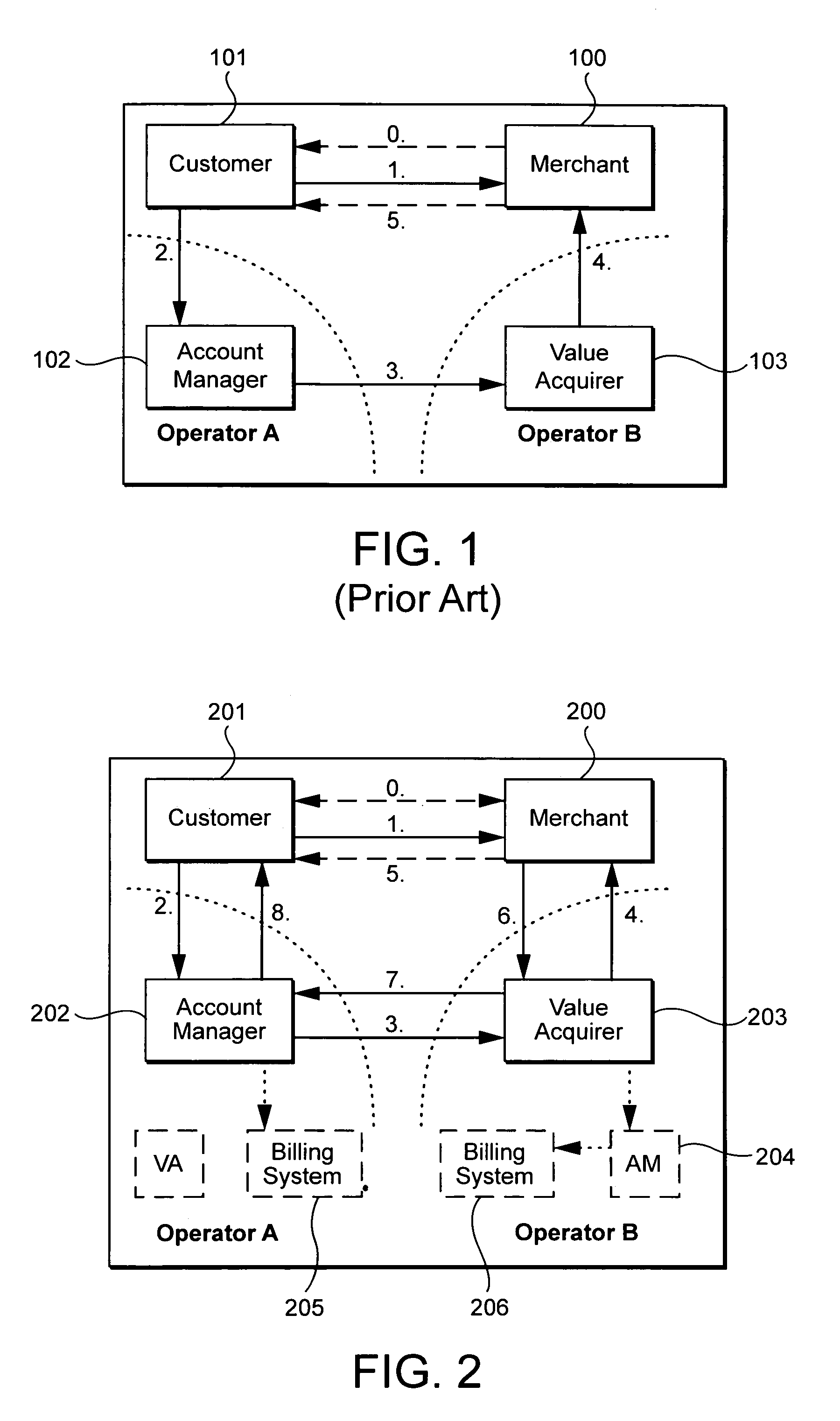

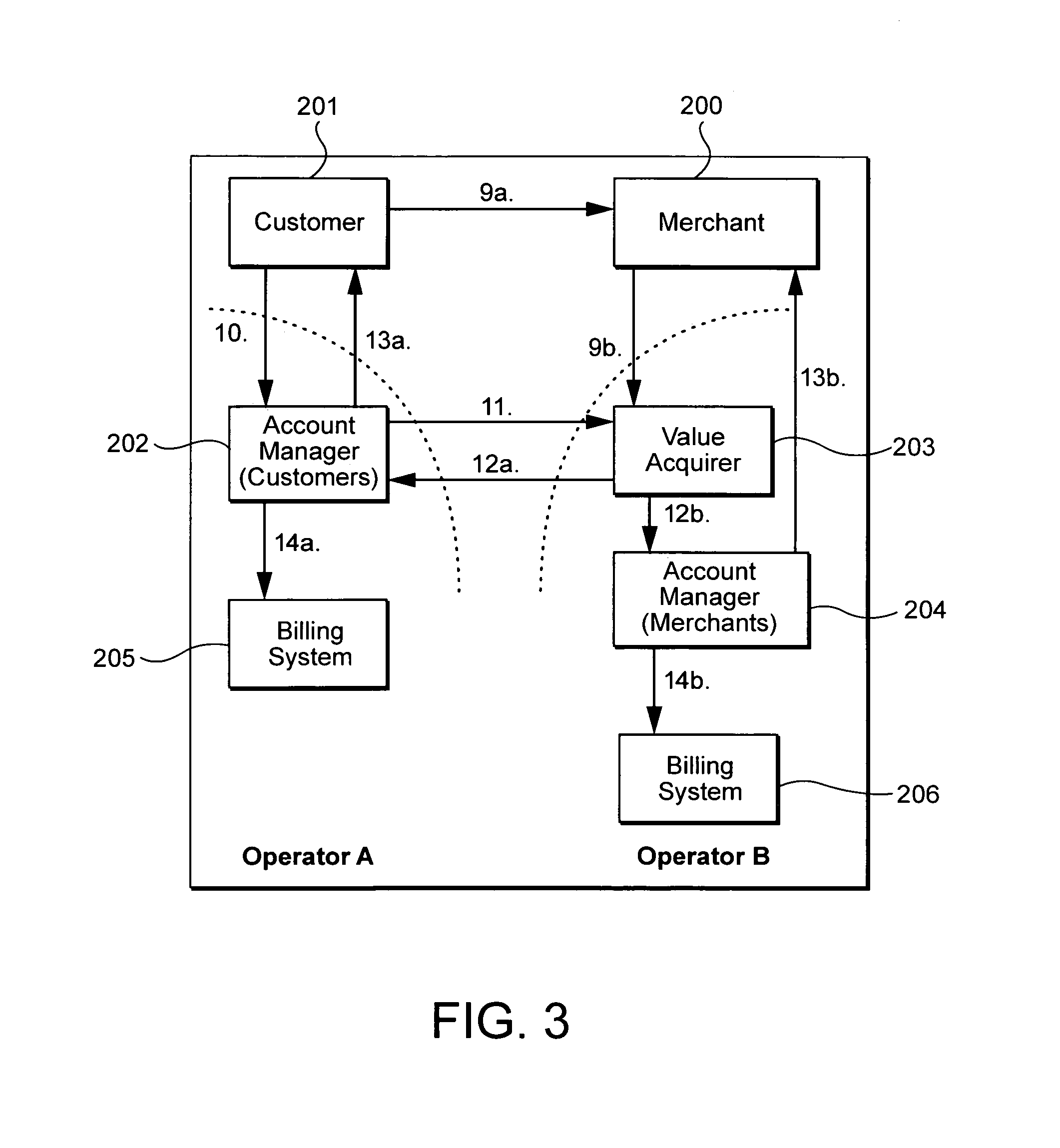

Payment system and method for use in an electronic commerce system

InactiveUS7146342B1Reduces transfer and processing costProtected from abuseComplete banking machinesFinanceClient agentMerchant account

A method and system of payment of goods and services in an electronic commerce system reduces the transfer and processing costs for each purchase made by a customer from a merchant. A customer agent, a merchant agent, and account manager associated with the agents administer customer accounts and merchant accounts. A mediating trusted agent associated with one of the account managers and merchant agent transactions during a trading session. The customer agent and merchant agent, the account manager, and the mediating trusted agent are interconnected by an electronic communication network.

Owner:TELEFON AB LM ERICSSON (PUBL)

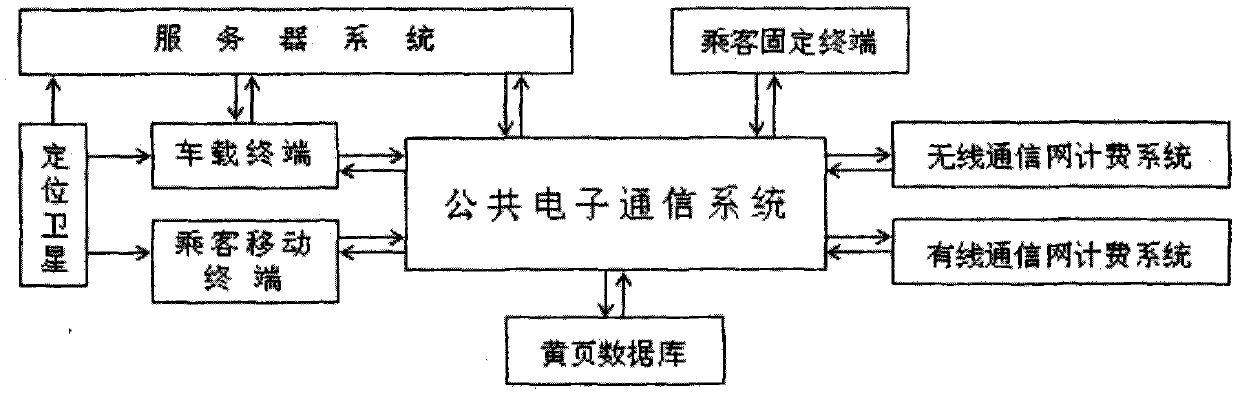

Intelligent system and method for managing and scheduling taxis

InactiveCN102682593ASolve the problem of deliberate detourReduce transportation expensesRoad vehicles traffic controlWired communicationDriver/operator

The invention discloses an intelligent system for managing and scheduling taxis, which comprises a server system for managing and scheduling the taxis, taxi-mounted terminals, passenger terminals, a location satellite, a yellow page database, a wireless communication network charging system, a wired communication network charging system and a public electronic communication network, wherein electronic communication among the server system, the taxi-mounted terminals, the passenger terminals, the location satellite, the yellow page database, the wireless communication network charging system, the wired communication network charging system and the public electronic communication network is used for managing and scheduling the taxis. The initial states of the taxis which are controlled by the server system are states of waiting to be provided with transporting services, and the initial state of one taxi subjected to site stopping, telecommunications ordering and relevant operations of a taxi driver becomes setting, leaving for a place of waiting, transporting service (cooperation), transporting service (individual), out of service, waiting for carrying passengers on the way, transporting of on-the-way passengers (cooperation), transporting of on-the-way passengers (individual) and the like. Under the condition that the taxi is in the state of transporting service (cooperation) or transporting of on-the-way passengers (cooperation) and the taxi is not filled with the passengers, cooperation transporting service or cooperation on-the-way passenger transportation that the quantity of the passengers is not more than the vacancy can also be accepted.

Owner:舒方硕

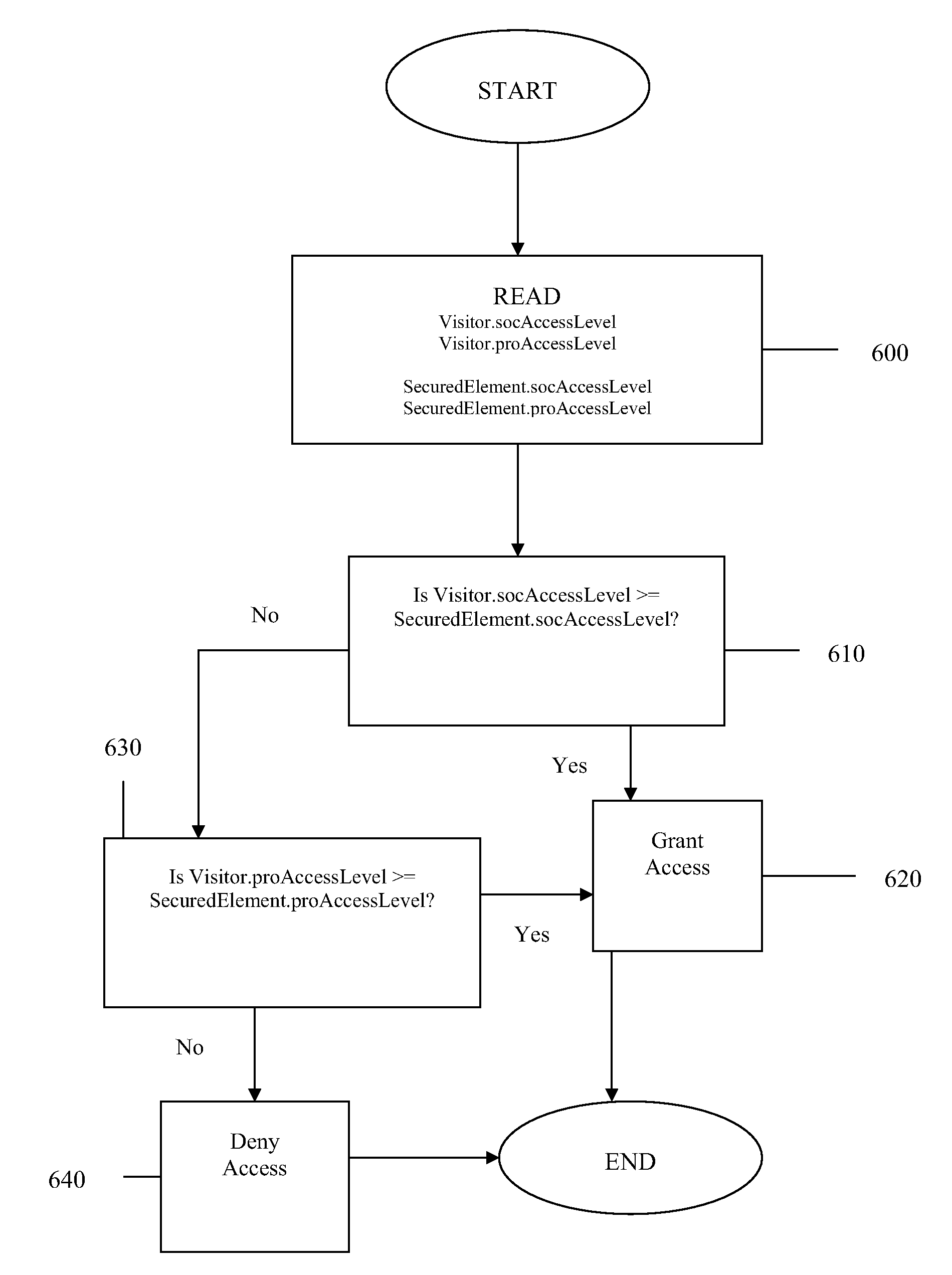

System and method for electronic social networking

InactiveUS20090024741A1Digital computer detailsOffice automationInternet privacyElectronic communication network

According to one embodiment, a system for controlling access to data on an electronic communication network is provided. The system includes at least one server connectable for communication on the network. The at least one server is configured for: receiving data from at least one user of a plurality of users, via the network; storing the received data; generating control levels corresponding to one or more portions of the stored data; receiving selected modifications to at least one of the generated control levels from the at least one user, via the network; providing controlled access to the one or more portions of the stored data according to the generated control levels and the modified at least one of the generated control levels.

Owner:ROACH SEAN

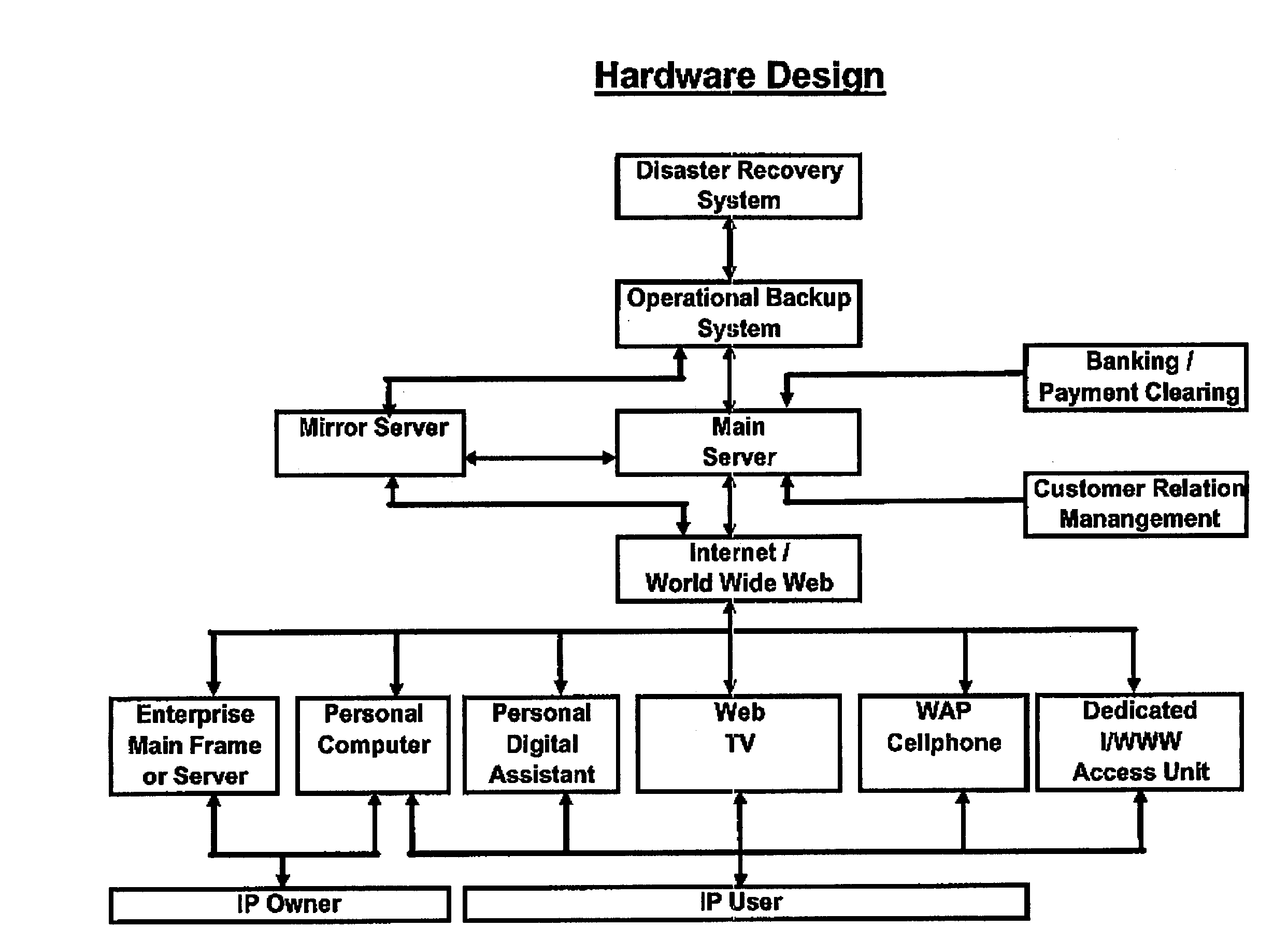

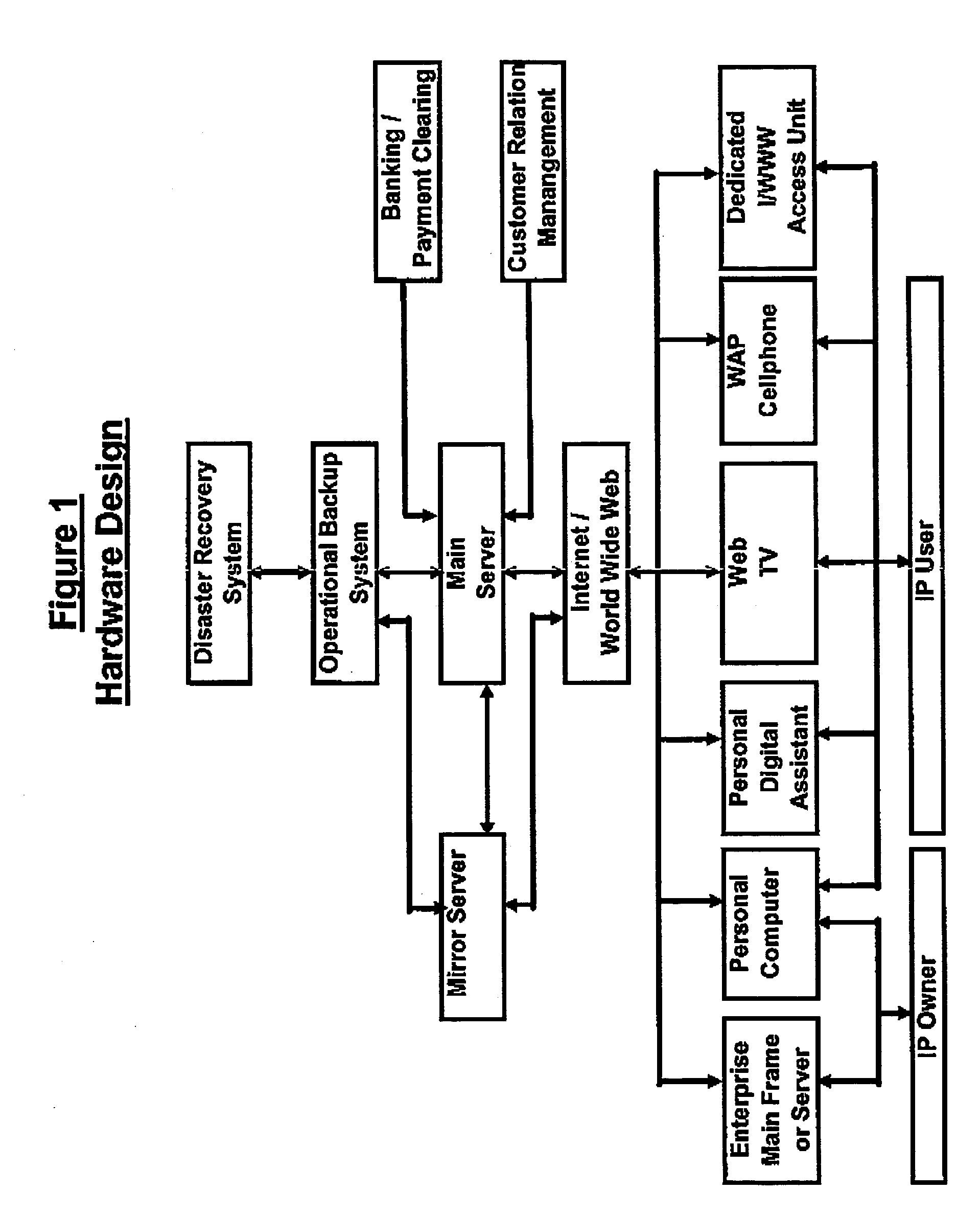

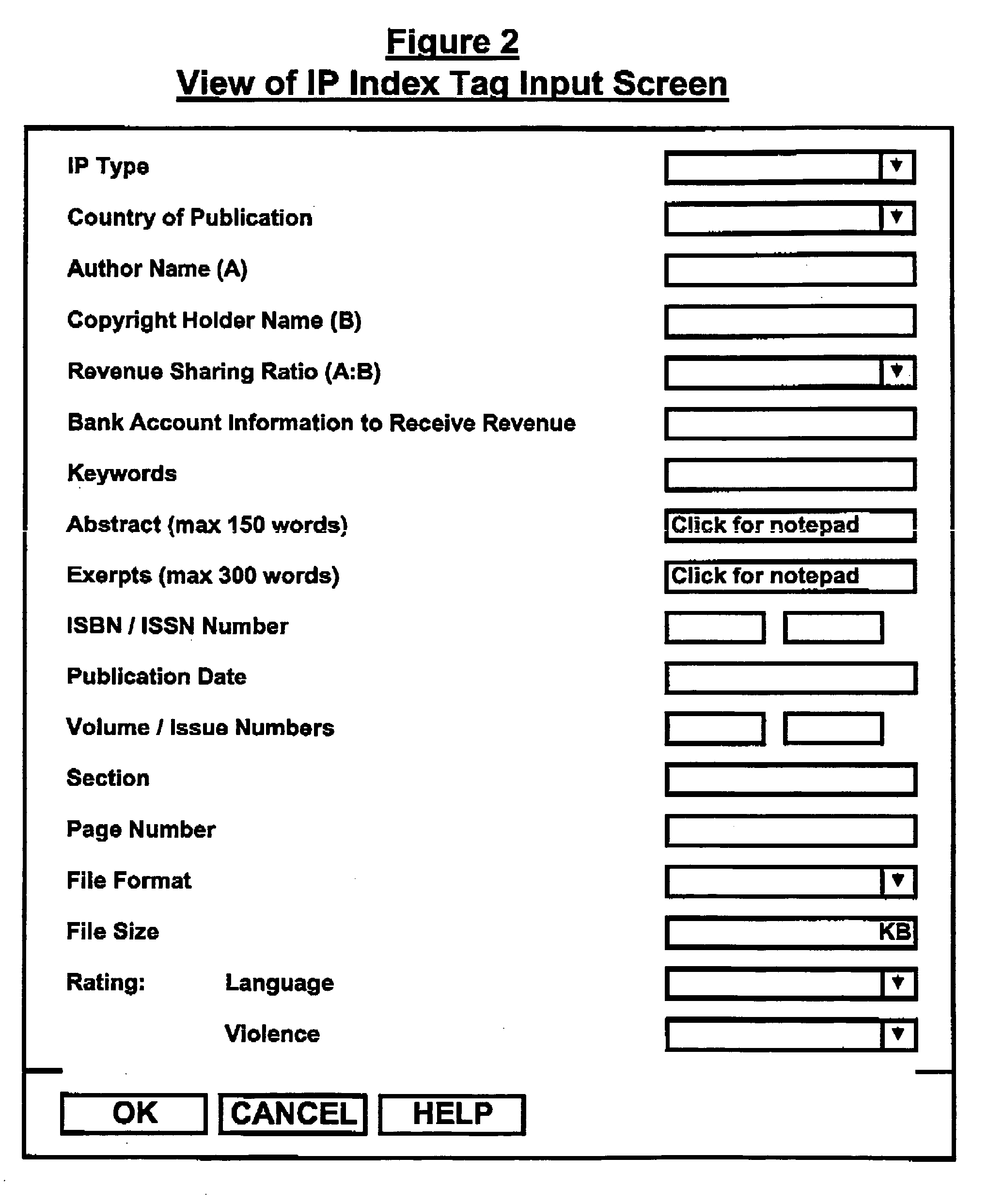

Method for the assured and enduring archival of intellectual property

ActiveUS7194490B2Improve search efficiencyBig economyDigital data processing detailsOffice automationIntellectual propertyLibrary science

A technical and commercial method of managing information is provided including an endowment fund associated with each of the plurality of information or intellectual property (IP) to be archived. The endowment fund assures the maintenance and storage of the archived IP. Further, the endowment fund is managed separately from the user fees to ensure its enduring integrity and long term viability, with the user fees being applicable to user's access to the IP through an electronic communications network. Endowment funds for archived IP can be pooled for increased permanence. User's access to the archived IP can be managed including assignment of an access level and a cost for access. Users can access and amend a value-added access file associated with, yet separate from, the archived IP.

Owner:ZEE CHRISTOPHER

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com